Option pricing method based on backward stochastic differential equation (BSDE)

A technology of stochastic differential equations and options, applied in the direction of machine execution devices, instruments, complex mathematical operations, etc., can solve problems such as performance bottlenecks, many execution times, and many simulation times, and achieve the effect of performance improvement

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

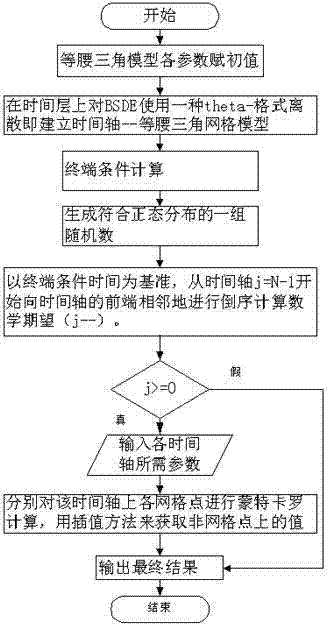

Method used

Image

Examples

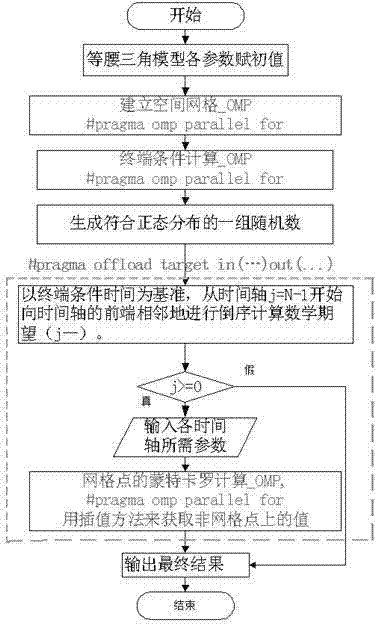

Embodiment 1

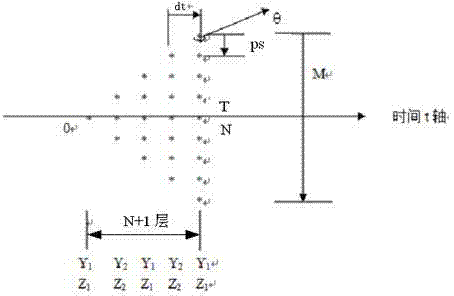

[0058] Specific implementation 1: In the entire spatial grid, the grid points on each event layer are executed sequentially, controlled by a for loop. In order to improve concurrency, the decrement of the loop is 2, and in each loop, execute twice Hotspot function, that is, the option pricing operation on two time layers, the starting index of each layer is controlled by the expression Ps*(N-j), and the values of Y and Z are alternately stored by two groups of Y1, Z1 and Y2, Z2 for each time The Y and Z values calculated by the layer, which in turn assist in executing the kernel function twice per loop. The implementation process is as follows:

[0059] / / Control the time layer, execute the kernel function twice in each cycle

[0060]for(j=N-1;j>=0;j=j-2)

[0061] {

[0062] ii=Ps*(N-j);

[0063] {

[0064] Call the option price kernel function

[0065]}

[0066] Determine whether the control variable of the time layer is greater than 0

[0067] if greater than ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com