Financial industry oriented customer authentication system and method

An authentication system and authentication method technology, applied in finance, instruments, data processing applications, etc., can solve problems such as increased difficulty and implementation cost, increased difficulty and cost of management and operation and maintenance, and inability to provide a unified biometric database. Achieve the effect of breaking the barriers of enterprise information islands, meeting expansion/replacement requirements, and reducing dependency binding

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

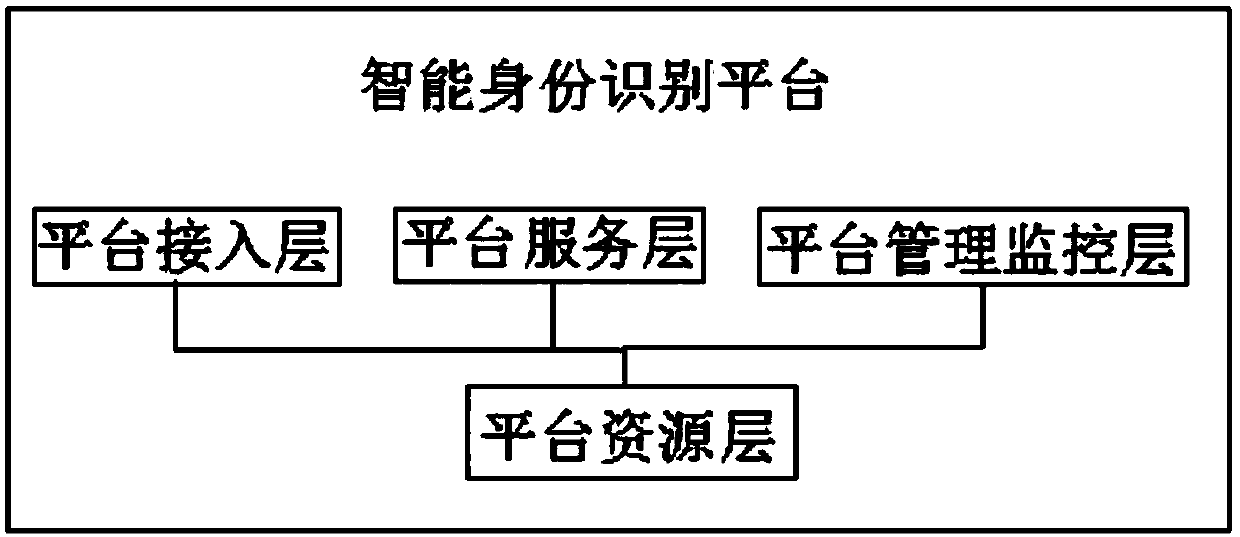

[0049] Embodiment 1, the embodiment of the present invention provides a customer authentication system for the financial industry, see figure 2 , including an intelligent identity recognition platform, the intelligent identity recognition platform includes a platform access layer, a platform service layer, a platform management and monitoring layer, and a platform resource layer;

[0050] The platform access layer is responsible for integrating the real-time transaction data of the platform, and providing an enterprise-level, standard, and unified authentication service interface for the entire system;

[0051]Specifically, the platform access layer includes an access service component, and the access service component is responsible for receiving request data from related applications or channels, preprocessing the request data, and extracting the authentication channel number from the header of the corresponding request data Querying the corresponding interface number accor...

Embodiment 2

[0084] Embodiment 2. On the basis of Embodiment 1, in this embodiment, different authentication methods and combined services can be flexibly configured based on different application scenarios. Specifically, the system combines user authentication methods with risk control, Evaluate the security strength of the user's business scenario through the user's transaction location, device identification, and transaction amount; according to the security strength requirements of the business scenario, refer to Figure 11 Through the effective combination or separation of authentication service components in the platform service layer, multi-modal and multi-factor authentication services can be flexibly configured to ensure the security of scene transactions and the accuracy of identity recognition, providing services for the entire bank, omni-channel and interbank finance Application systems or devices provide fast, unified and transparent authentication services.

Embodiment 3

[0085] Embodiment three, on the basis of embodiment two, in this embodiment, see Figure 12 , the system provides an interface with the third-party service system, provides bank authentication services for the third-party service system, reduces third-party repeated investment and operation and maintenance problems, and provides high-quality biometric services for individual users of various customer channels of the bank. According to the service agreement of the third-party service system, provide corresponding biometric services for the third-party service system; the system also has a security service platform that integrates third-party organizations / institutions with security qualifications outside the bank through interfaces. Preferably, it is connected with the witness comparison service system of the public security department. Specifically, the platform service layer is connected to the witness comparison service system of the Ministry of Public Security. When the pla...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com