Credit evaluation method for optimizing generalized regression neural network based on grey wolf algorithm

A neural network and generalized regression technology, applied in the risk control field of the Internet finance industry, can solve problems such as mutation, long training time, and falling into local extreme areas.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

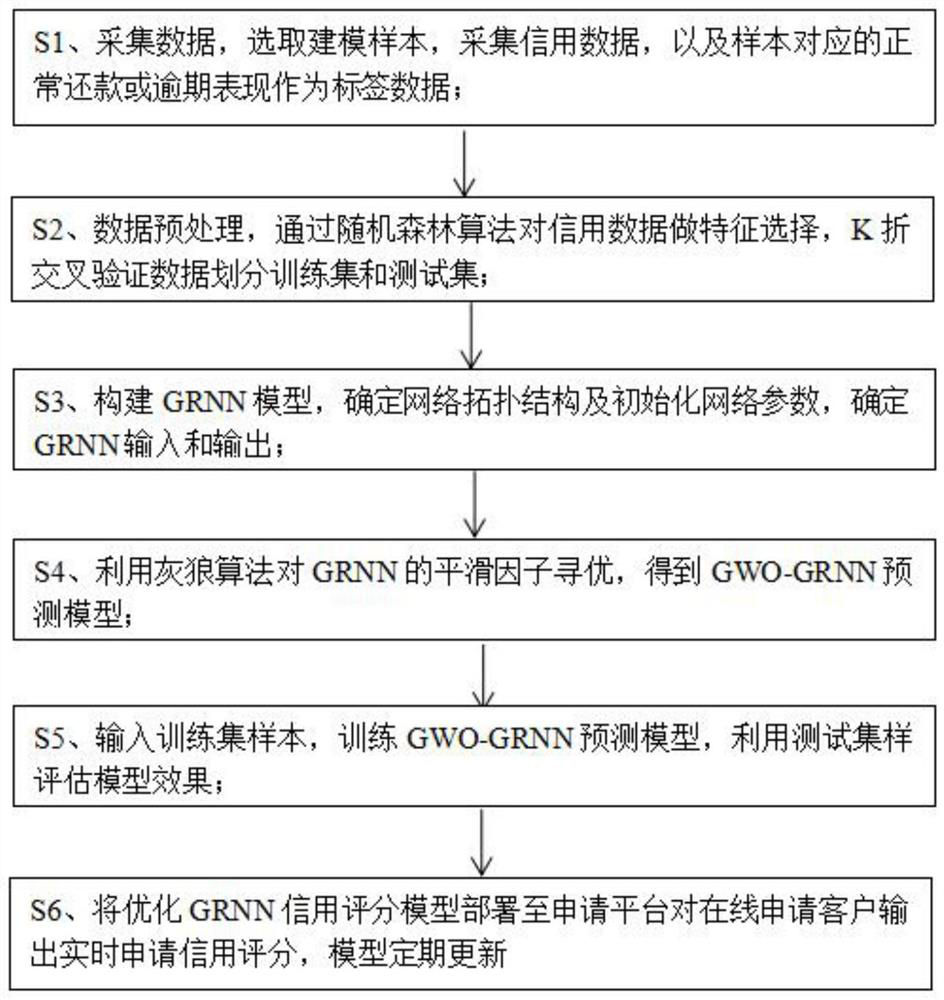

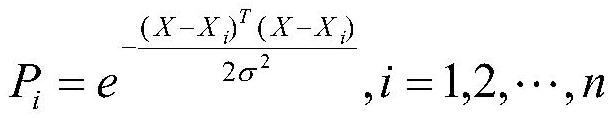

[0082] see figure 1 , the present invention provides a technical solution:

[0083] A credit evaluation method based on the gray wolf algorithm to optimize the generalized regression neural network, including the following six steps:

[0084]S1. Collect data, select a certain proportion and quantity of normal repayment and overdue customers from the back end of the Internet financial platform according to the post-loan performance as modeling samples, collect the basic personal information of the sample customers when they apply for account registration, and obtain operational behavior embedded in the monitoring software The point data is used as credit data, and the normal repayment or overdue performance corresponding to the sample is used as label data;

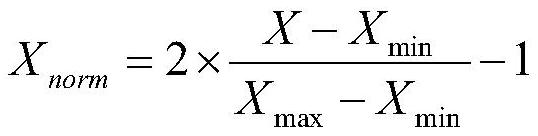

[0085] S2. Data preprocessing, after performing missing completion, outlier processing and normalization processing on the collected credit data, feature selection is performed on the credit data through the random forest...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com