Patents

Literature

142results about How to "Strong non-linear mapping ability" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Power grid security situation predicting method based on improved deep learning model

InactiveCN104794534AFast predictionStrong non-linear mapping abilityForecastingDeep belief networkMulti input

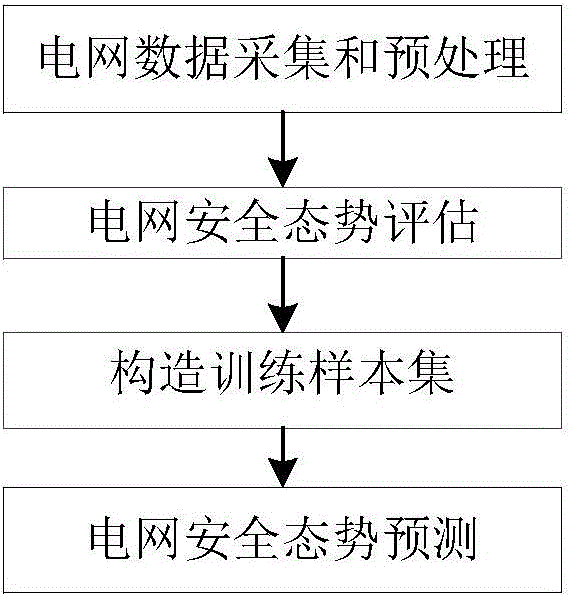

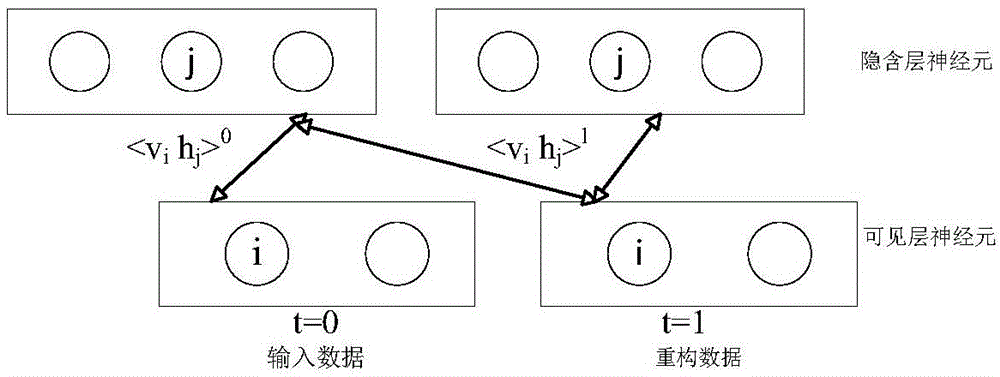

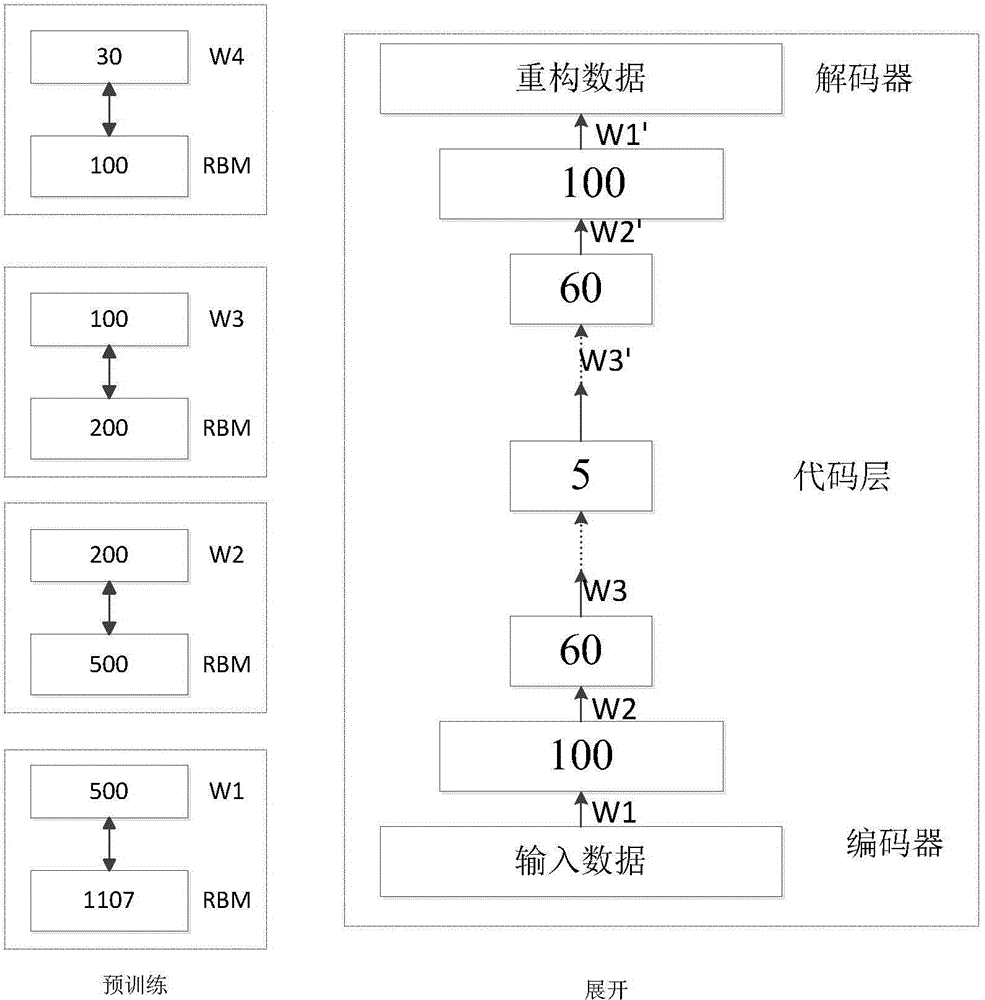

The invention discloses a power grid security situation predicting method based on an improved deep learning model and belongs to the technical field of power system safety. The power grid security situation predicting method includes: performing power grid security situation evaluation through power grid data collection and preprocessing; aiming at the characteristic that indicator data of power grid security situation evaluation are high in relevance and dimension, providing an improved self-coding network method to lower dimension of the indicator data, and utilizing a data sample after dimension reduction and a power grid security situation value corresponding to a next time monitoring point; adopting an improved deep belief network to build a deep learning situation predicting model with multi-input and multi-output for power grid security situation prediction. By the power grid security situation predicting method, speed and accuracy of power grid security situation prediction can be improved effectively.

Owner:STATE GRID SHANDONG ELECTRIC POWER

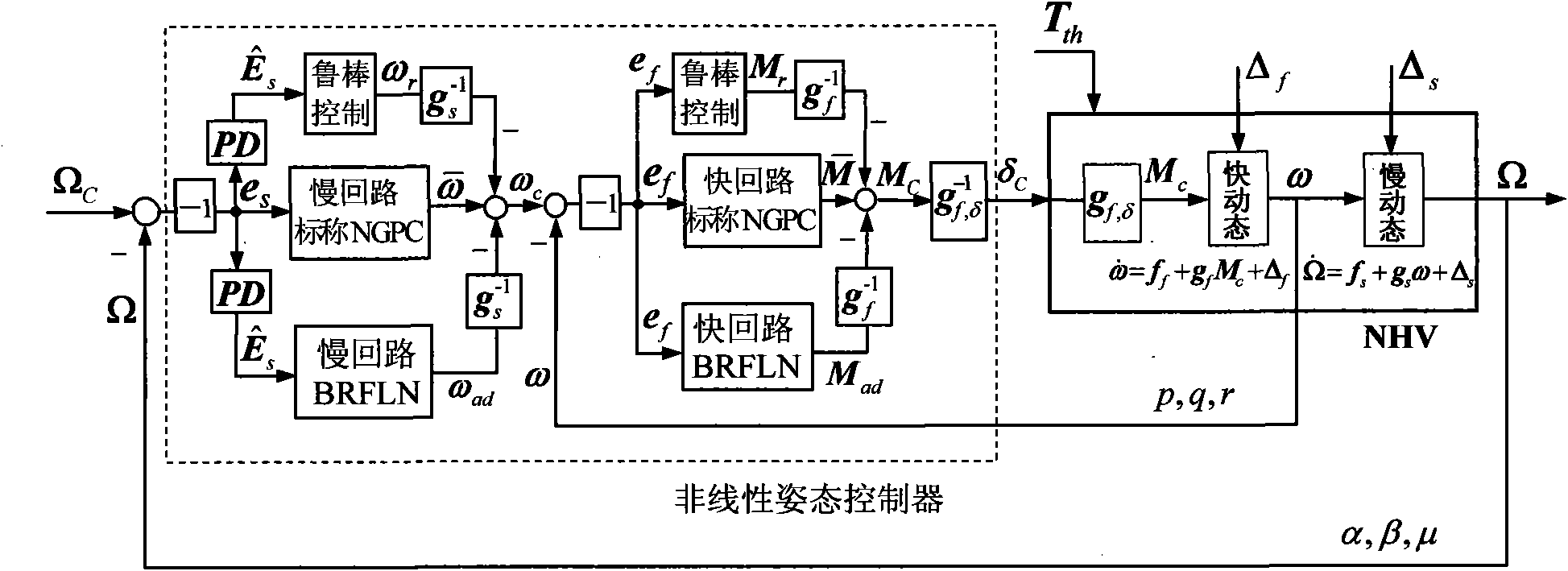

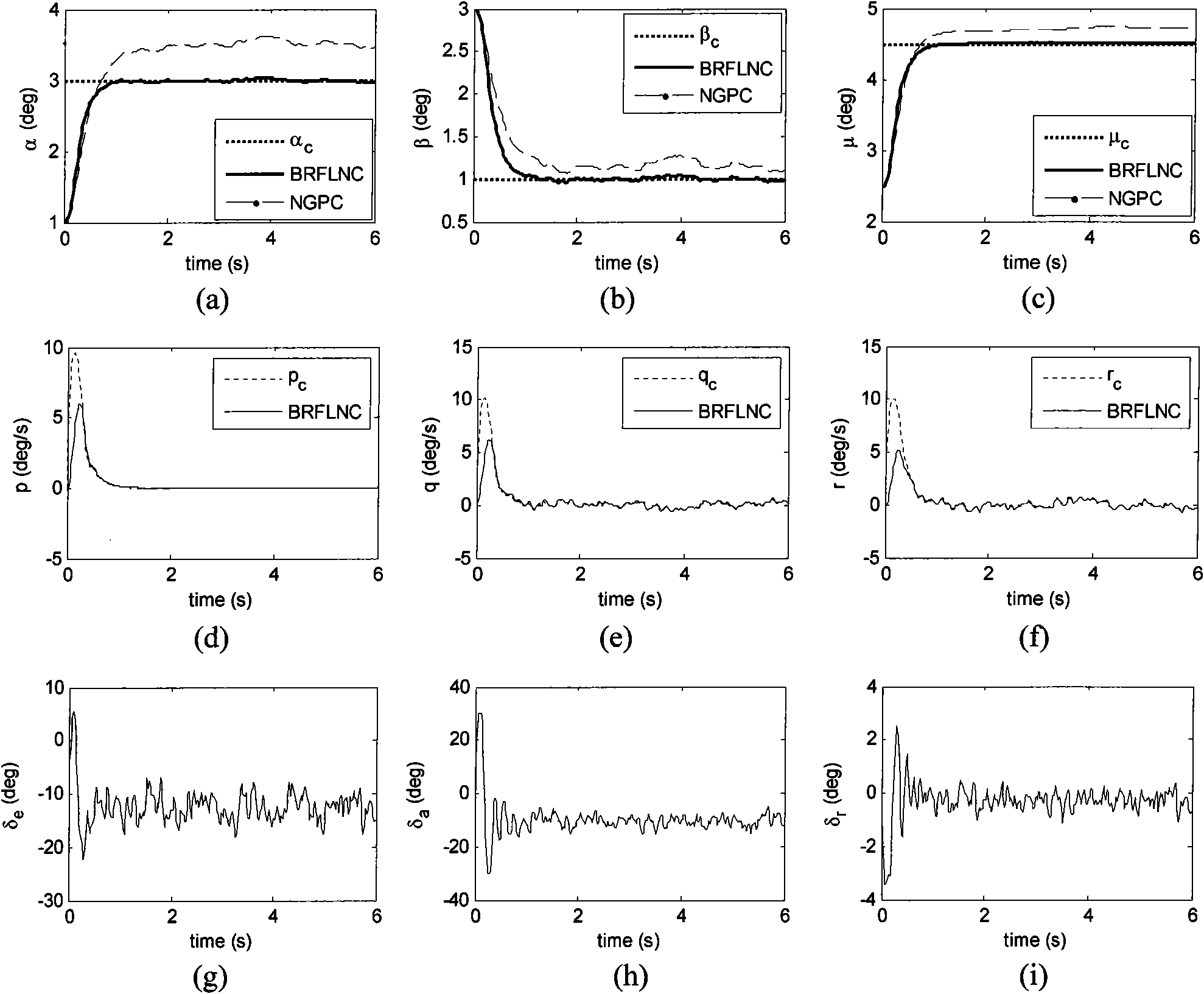

Nonlinear self-adaption control method of near-space hypersonic vehicle

InactiveCN101937233ATake advantage ofLighten the computational burdenAttitude controlAdaptive controlAviationNonlinear adaptive control

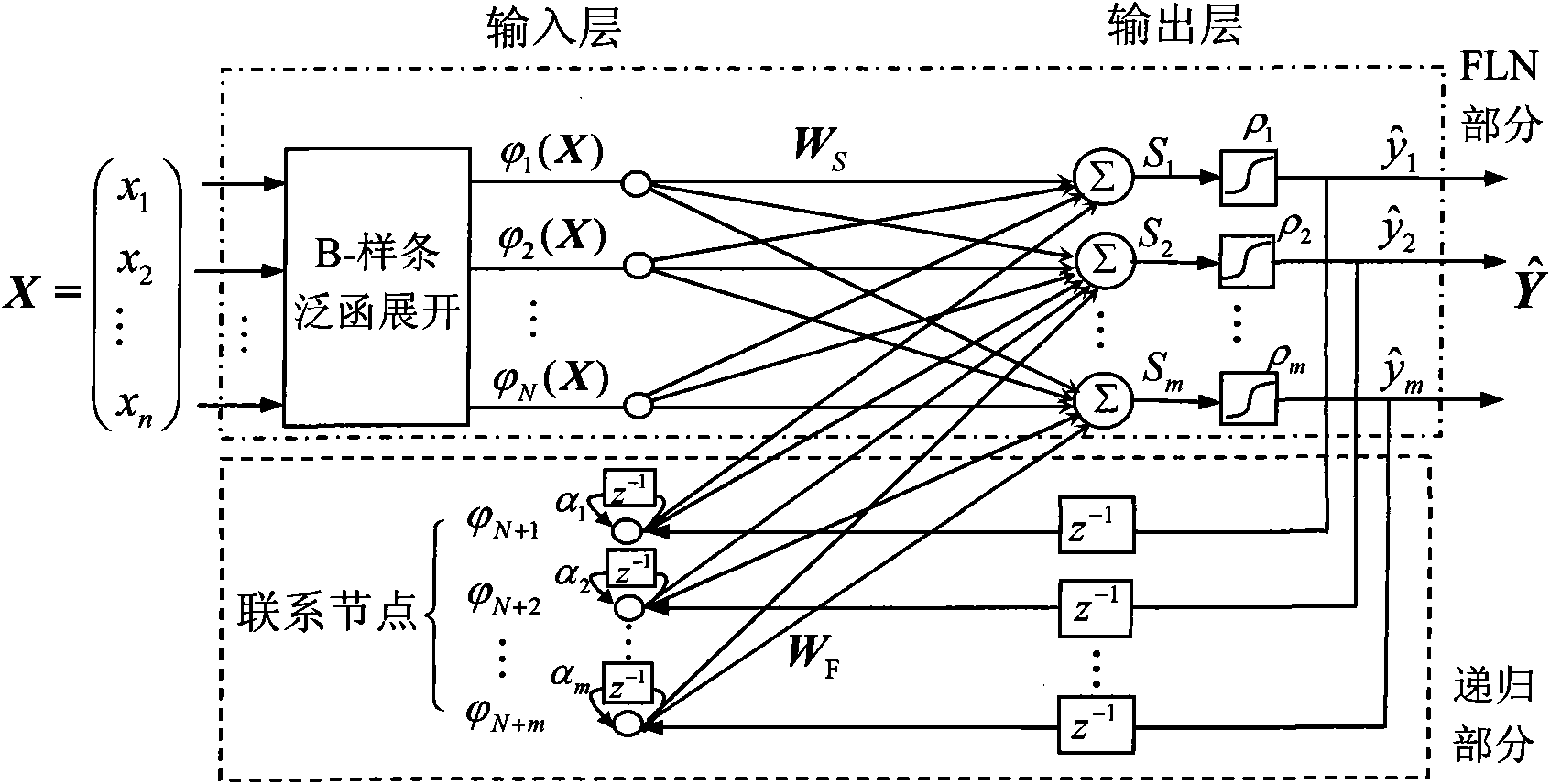

The invention discloses a nonlinear self-adaption control method of near-space hypersonic vehicle (NHV), which belongs to a flight control method in the technical field of aerospace. The control method mainly comprises three control law parts: a nominal nonlinear generalized predictive control law (NGPC), a B-spline recursive functional linkage network (BRFLN) self-adaption control law, and a robust control law of gain self-adaption adjustment. The invention integrates the simplicity of the NGPC method and the effectiveness of dynamic uncertainty of the BRFLN learning, targets the immeasurable dynamic uncertainty and fast interference of an attitude system in the flight of the NHV, brings favorable learning effect, and realizes the nonlinear accurate control to the attitude angle.

Owner:NANJING UNIV OF AERONAUTICS & ASTRONAUTICS

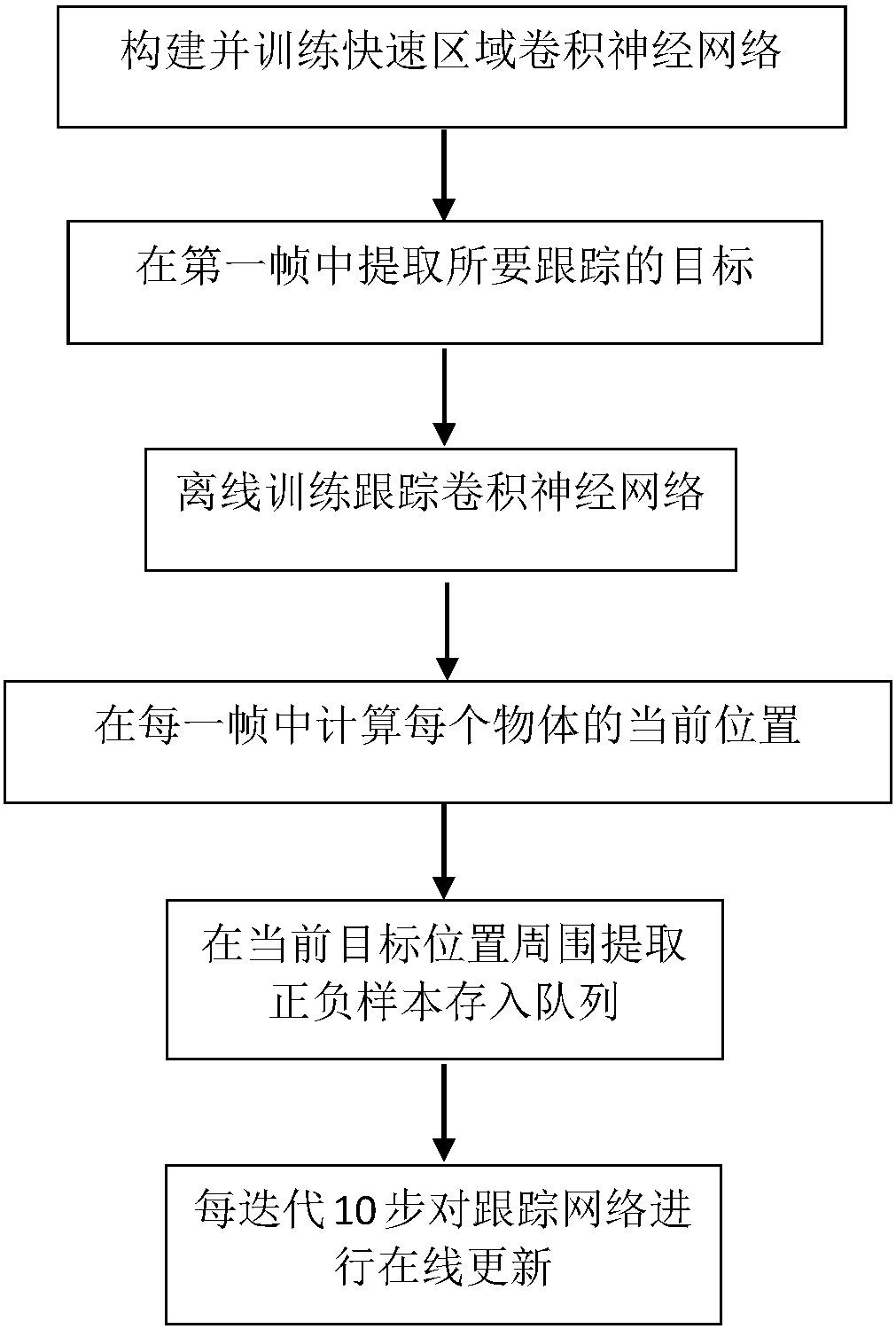

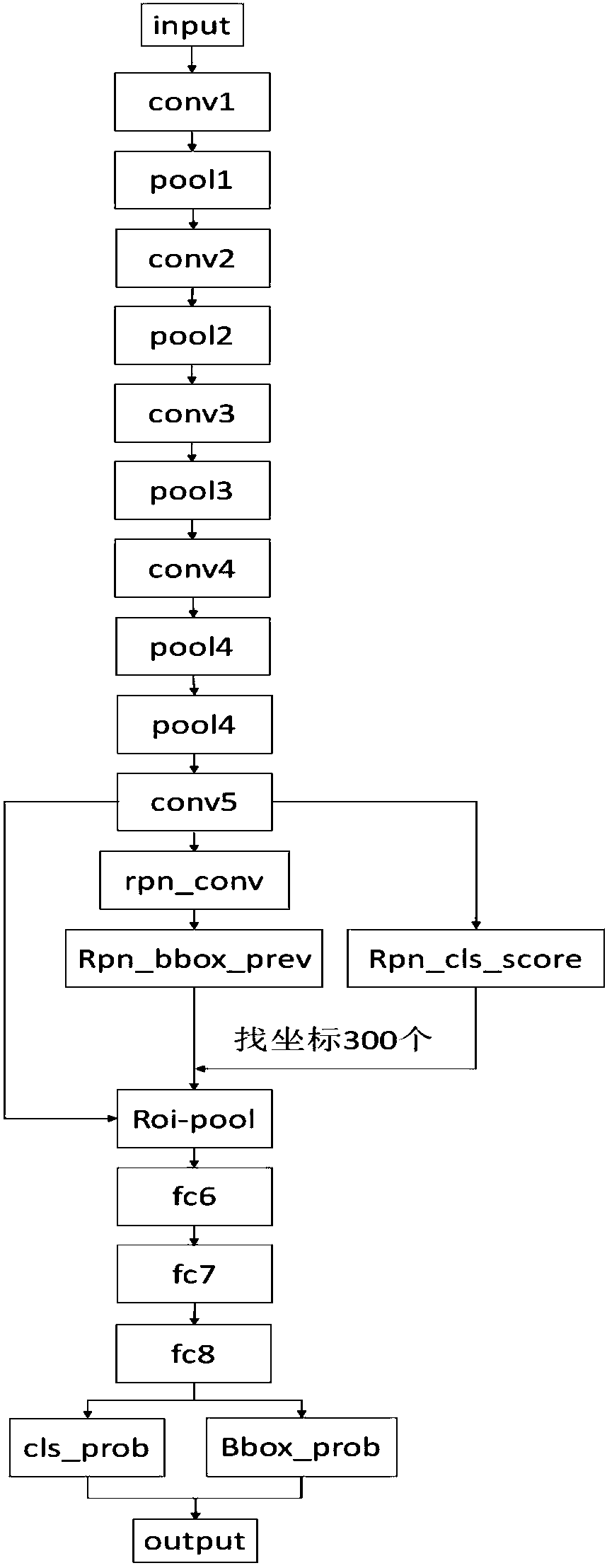

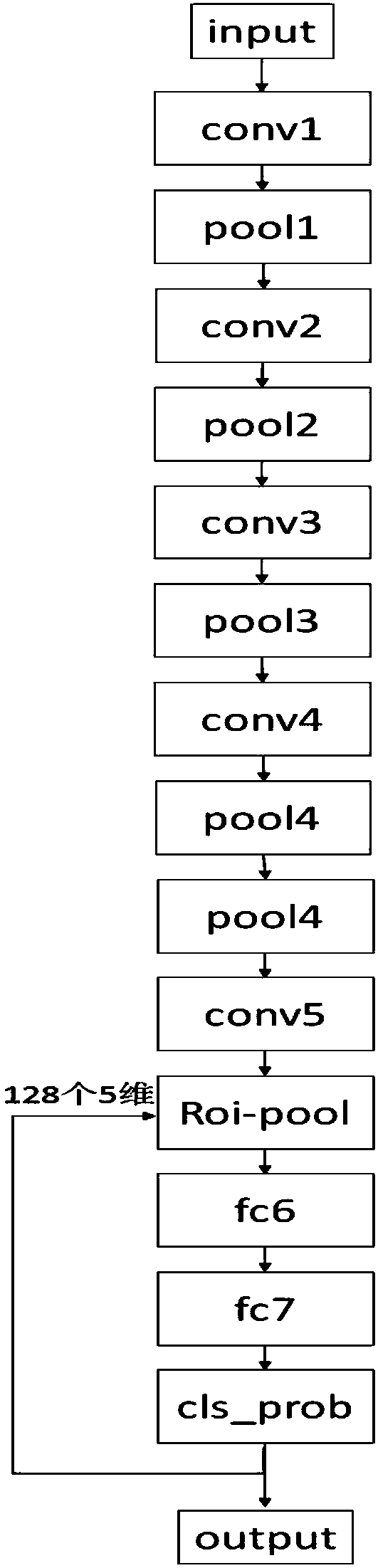

Vehicle recognition and tracking method based on convolutional neural networks

ActiveCN108171112AStrong nonlinear fitting abilityEasy to learn the rulesCharacter and pattern recognitionNeural architecturesOnline offlineConvolution

The invention discloses a vehicle recognition and tracking method based on convolutional neural networks. Through the method, the problem that it is difficult to guarantee instantaneity under a high-precision condition in the prior art is solved, and the defects of inaccurate classification results, long tracking and recognition time and the like are overcome. The method comprises the implementation steps that a quick region convolutional neural network is constructed and trained; an initial frame of a monitoring video is processed and recognized; a tracking convolutional neural network is trained off line; an optimal candidate box is extracted and selected; a sample queue is generated; online iterative training is performed; and a target image is acquired, and instant vehicle recognitionand tracking are realized. According to the method, a Faster-rcnn and the tracking convolutional neural network are combined, and high-level features with good robustness and high representativeness of vehicles are extracted by use of the convolutional neural networks; through network fusion and an online-offline training alternating mode, time needed for tracking and recognition is shortened on the basis of guaranteeing high precision; the recognition result is accurate, and tracking time is shorter; and the method can be used for cooperating with an ordinary camera to complete instant recognition and tracking of the vehicles.

Owner:XIDIAN UNIV

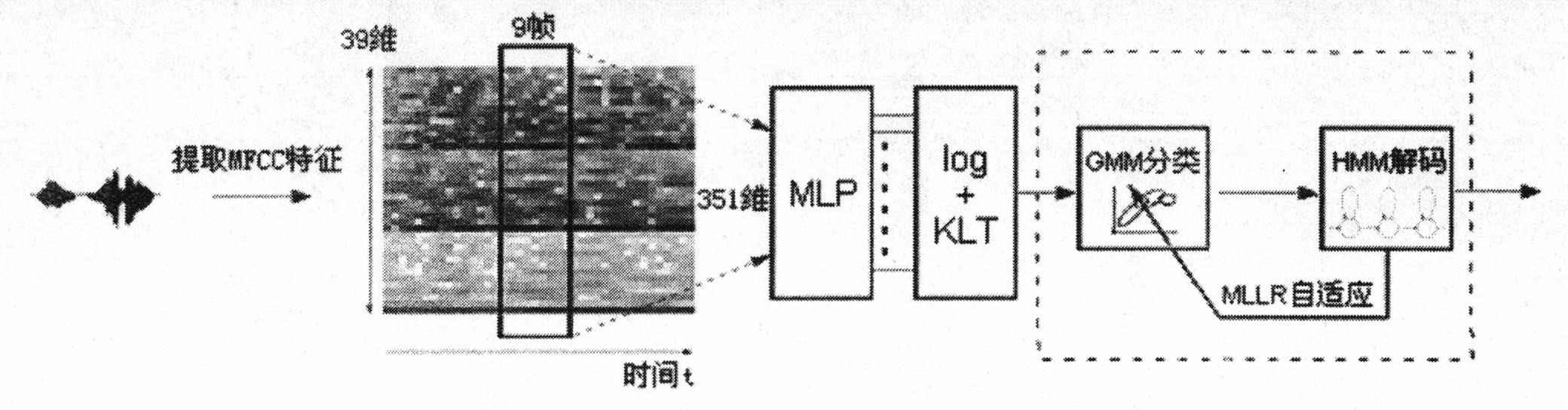

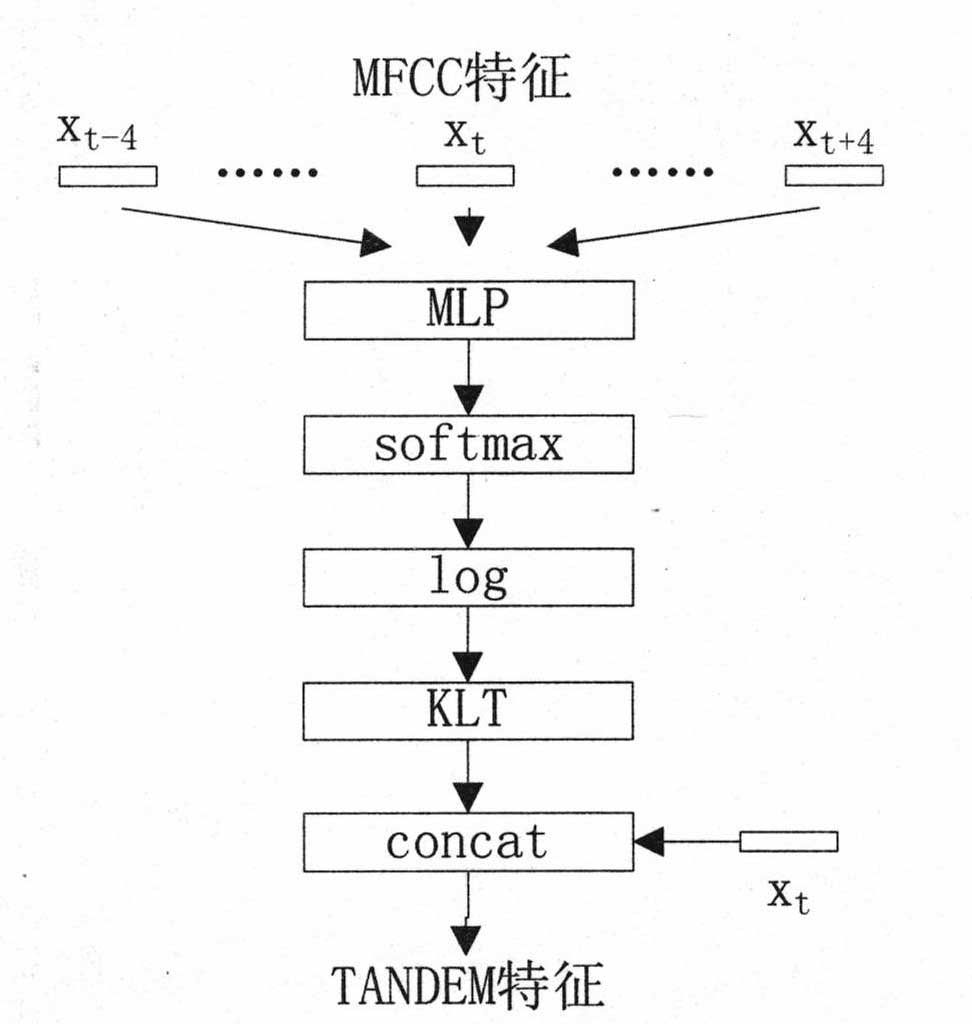

Speech error detection method by front-end processing using artificial neural network (ANN)

InactiveCN102122507AImprove error detection performanceImprove error detection abilitySpeech recognitionSpeech errorSpeech identification

The invention provides a speech error detection method by front-end processing using an artificial neural network (ANN). The method comprises the following steps: extracting new 64-dimensional features with strong pattern recognition capability and good discrimination property from 39-dimensional mel-frequency cepstrum coefficient (MFCC) parameters by utilizing a multilayer perceptron (MLP); performing speech recognition on test data by a machine, and generating a goodness of pronunciation (GOP) score; and pointing out pronunciation errors and error degree according to a set threshold, and performing directed-learning for pronunciation errors.

Owner:龚澍

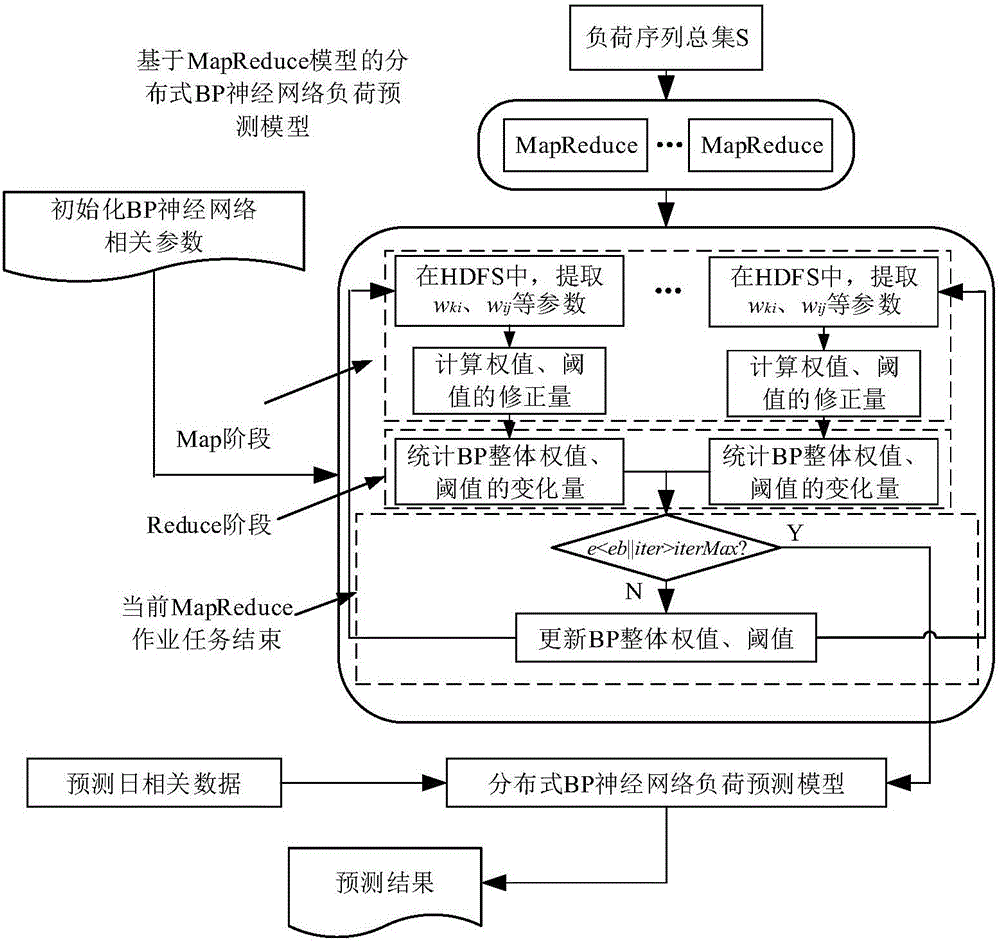

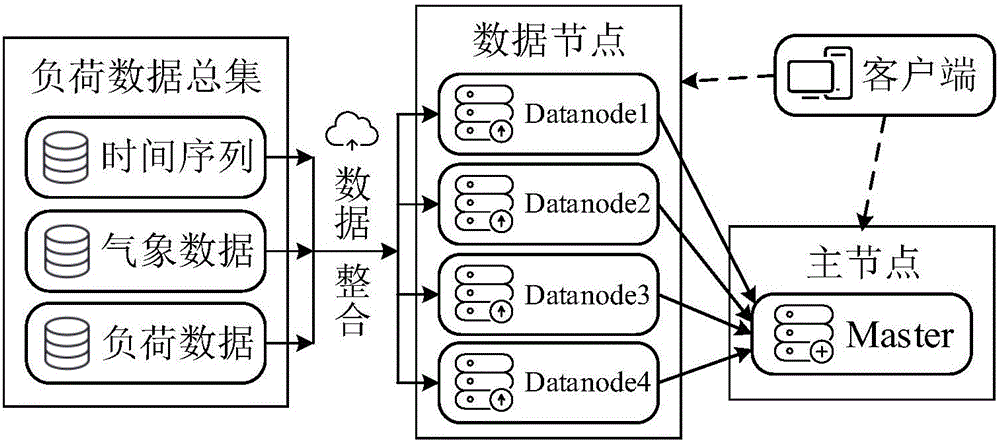

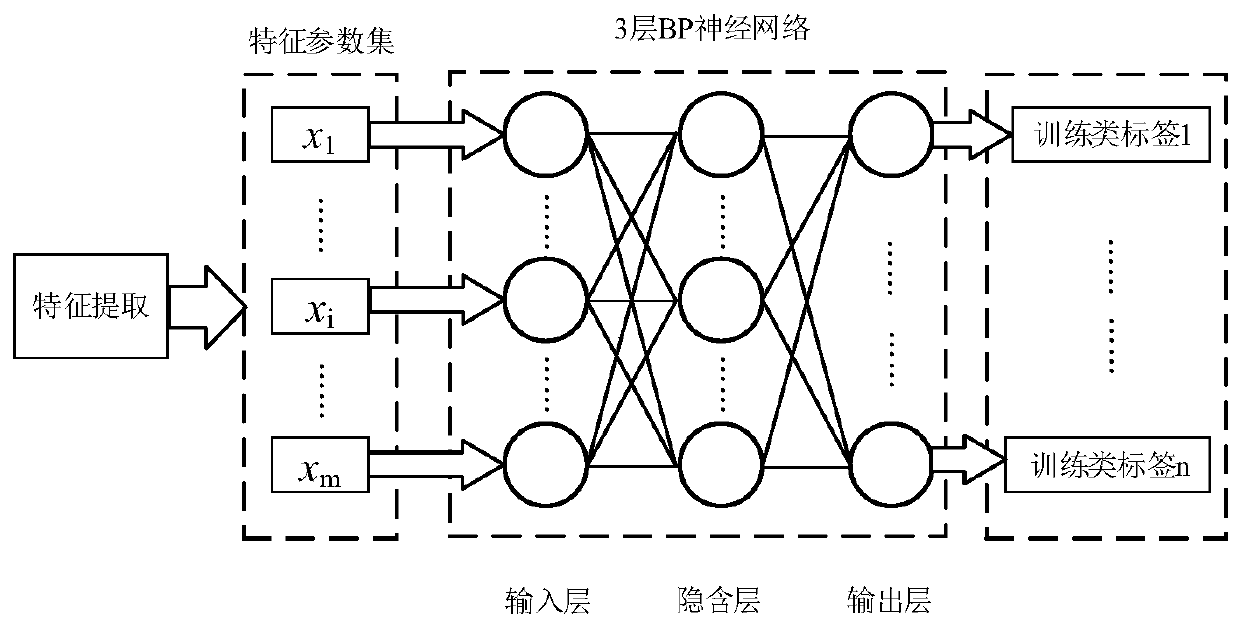

Hadoop framework-based short-term load prediction method for distributed BP neural network

ActiveCN106022521AStrong non-linear mapping abilityFast predictionBiological neural network modelsForecastingNODALCurrent load

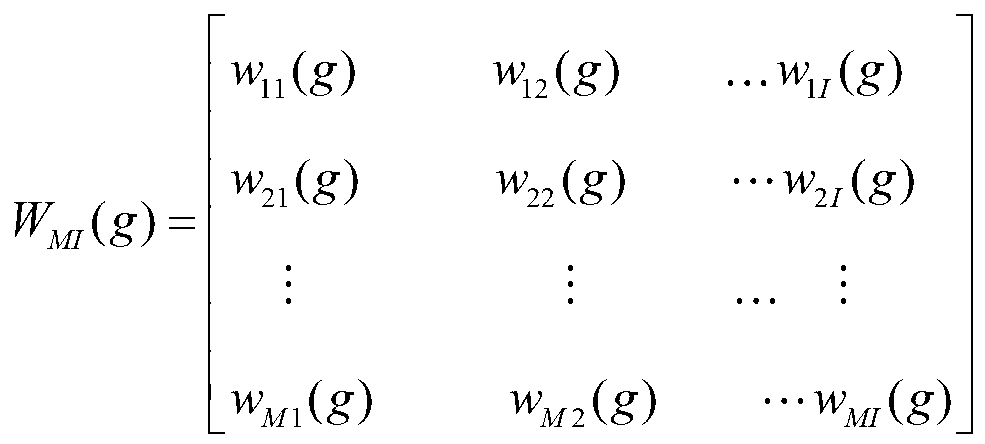

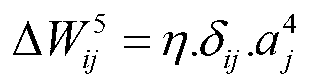

The invention discloses a Hadoop framework-based short-term load prediction method for a distributed BP (Back Propagation) neural network. The method specifically comprises the steps of obtaining an initial load data set; dividing the load data set into small data sets and storing the small data sets in data nodes of a distributed file system; initializing BP neural network parameters and uploading a parameter set into the distributed file system; training the BP neural network according to a current load sample, and obtaining correction values of a weight and a threshold of the BP neural network in the current data set; performing statistics on sum of weight and threshold parameters of all layers and between the layers of the network according to a key value of a key value pair; judging whether the convergence precision or the maximum iterative frequency is reached or not in a current iterative task, and if yes, establishing a distributed BP neural network model, or otherwise, performing correction of the weight and threshold parameters of the network; and inputting prediction day data and obtaining load power data of a prediction day. According to the method, the load prediction speed is increased and the requirements of load prediction precision are met.

Owner:SICHUAN UNIV

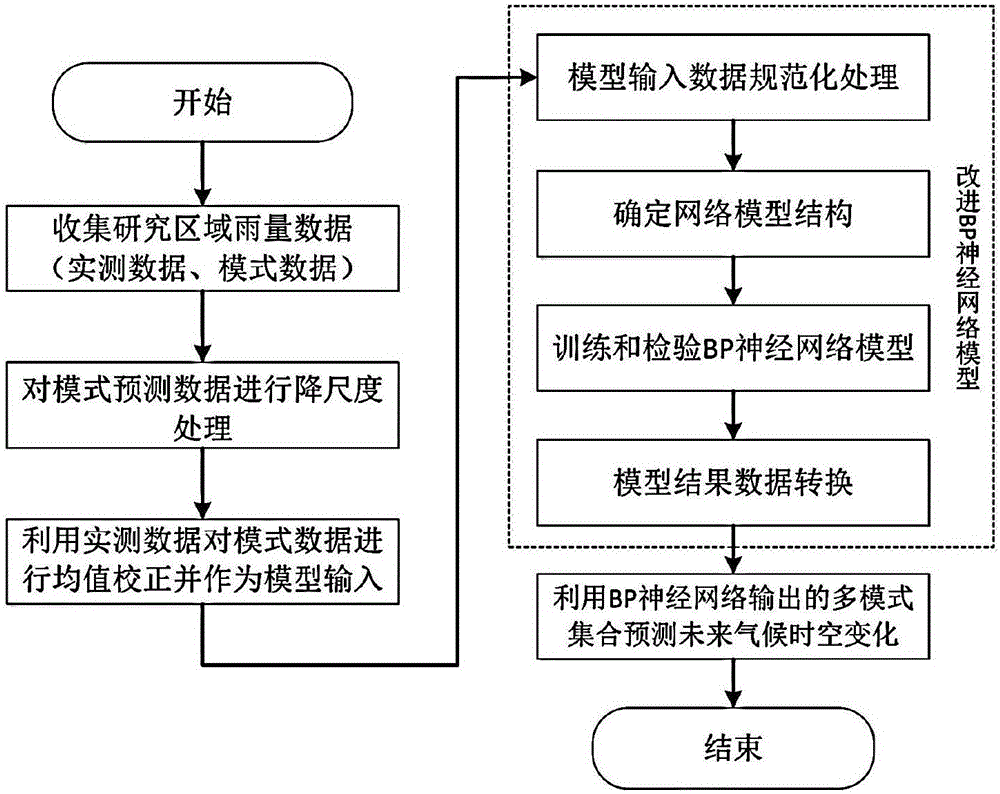

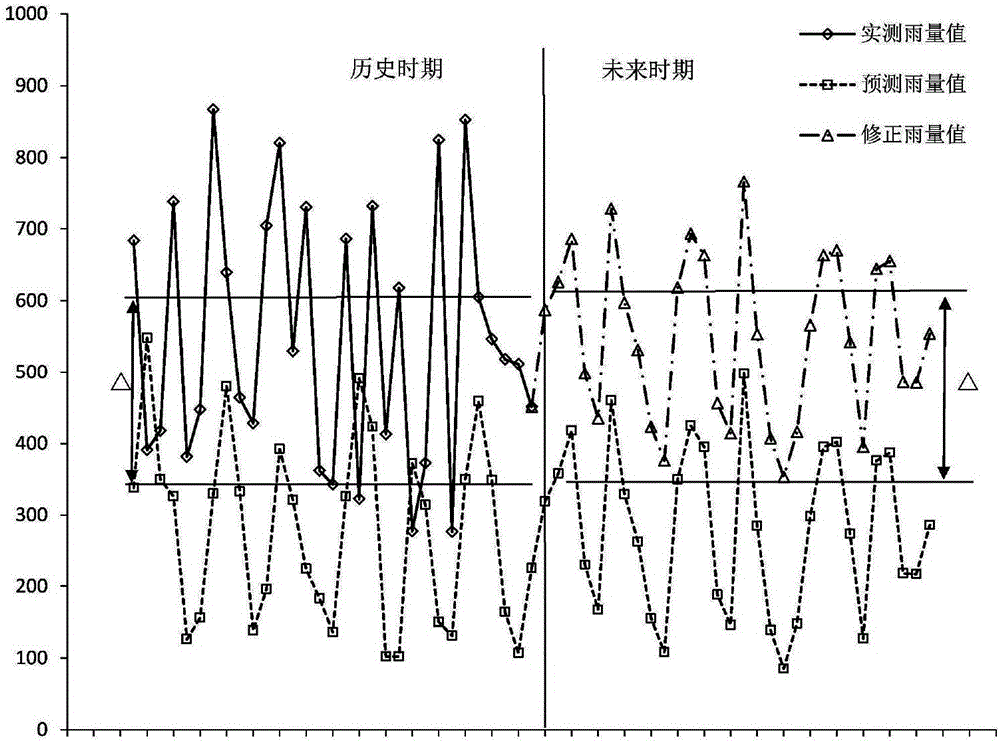

Climate change prediction method and system for fitting various climate modes based on modified BP neural network

ActiveCN105740991AImproved input and output data handlingImprove reliabilityForecastingNeural learning methodsFuture climateImage resolution

The present invention discloses a climate change prediction method and system for fitting various climate modes based on a modified BP neural network. The method comprises the following steps: collecting rainfall data that characterizes a climate change feature; performing downscaling processing on climate mode prediction grid data, so as to obtain a long series of data with the same resolution as measured data; performing average correction on a downscaled climate mode prediction series; establishing a modified BP neural network model and determining a network model structure; training and inspecting the established BP neural network model; and predicting a future climate spatial-temporal change using a model output. According to the method and system disclosed by the present invention, output / input data processing of the BP neural network is modified, and various climate modes are fit to predict the future climate change, so that reliability of the prediction result is increased, and the defects that the deviation of a single mode is relatively large during an assessment and that basin space nonuniformity is not considered during a multi-mode collection assessment and the like are made up.

Owner:HOHAI UNIV

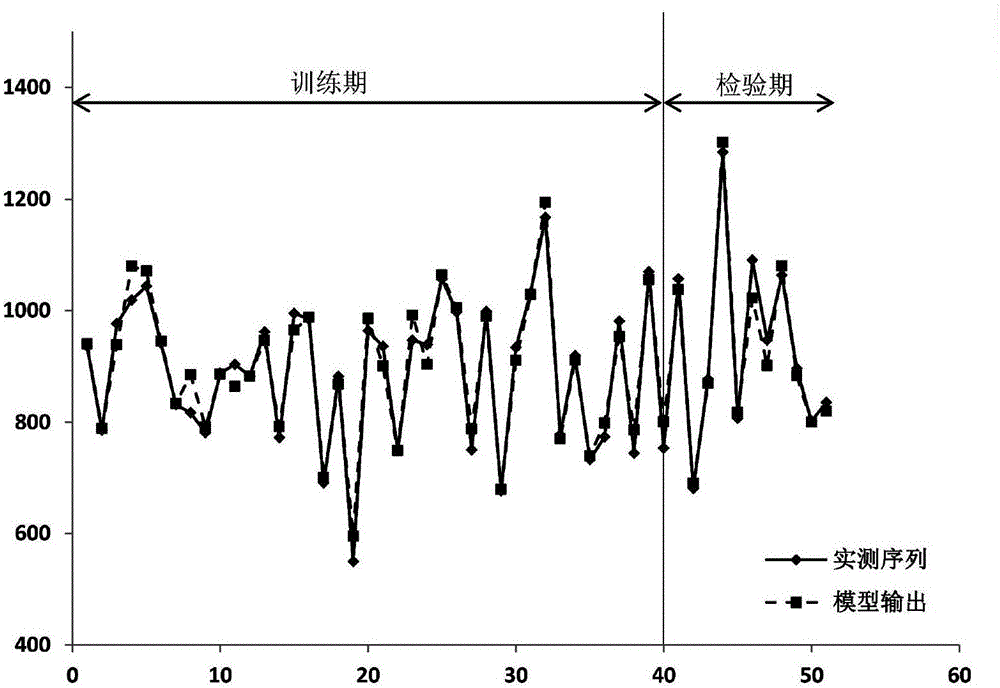

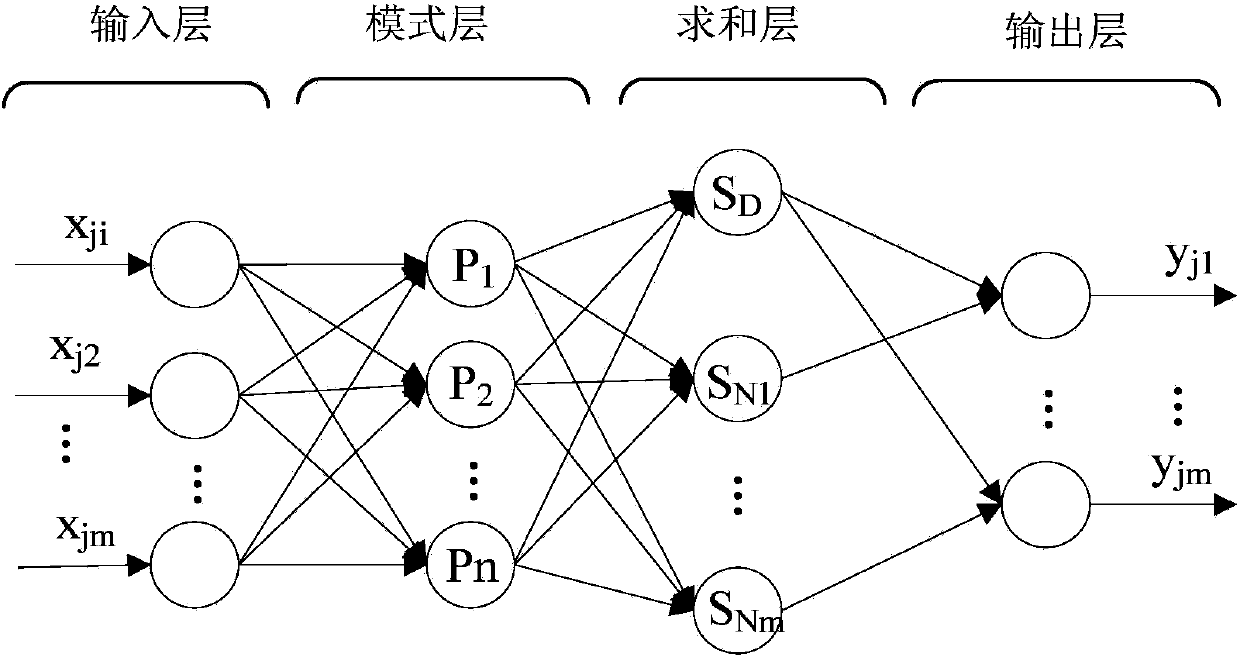

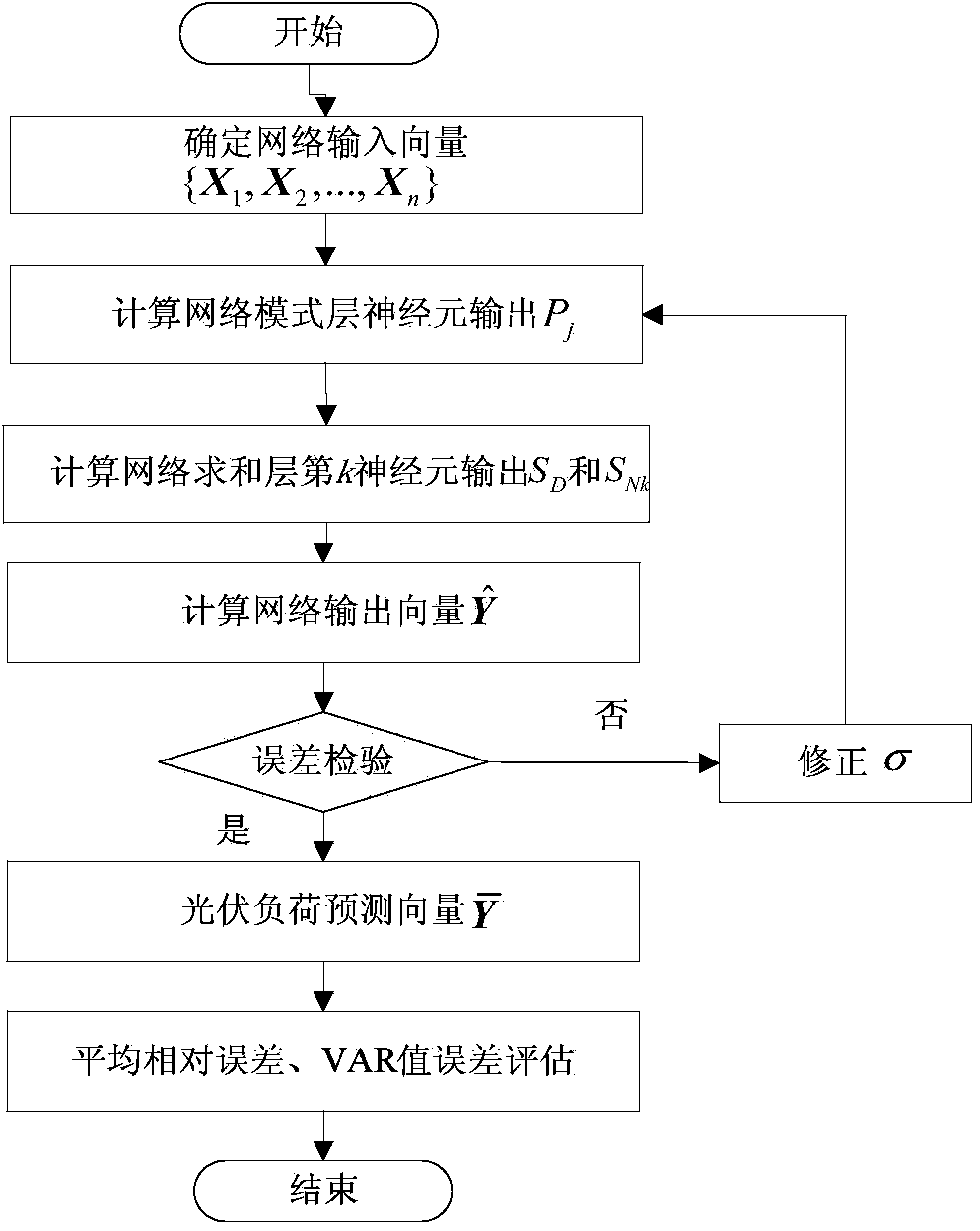

Photovoltaic power generation forecasting method based on GRNN

InactiveCN104050517AFast learningReduce training timeForecastingNeural learning methodsNon linear mappingSunlight

The invention relates to a photovoltaic power generation forecasting method based on a GRNN. According to the method, firstly factors such as solar terms, weather, and sunlight are considered to establish a photovoltaic curve pattern, then a photovoltaic power generation forecasting model based on the GRNN is provided, and a solution algorithm design is conducted. The method has the following advantages that weight does not need to be amended through error reverse calculation in the training process of the GRNN, and the transfer function can be adjusted by just changing a smoothing parameter Sigma, so that the training time is reduced, and the network learning speed is increased; a GRNN forecasting model is high in nonlinear mapping ability and good in approximation performance, and has good robustness, and thus is suitable for processing unstable data; the photovoltaic power generation forecasting technology of the GRNN obviously improves the forecasting accuracy; the forecasting result can provides decision information for grid photovoltaic scheduling, and has great significance in guaranteeing safe operation of the grid.

Owner:HARBIN INST OF TECH

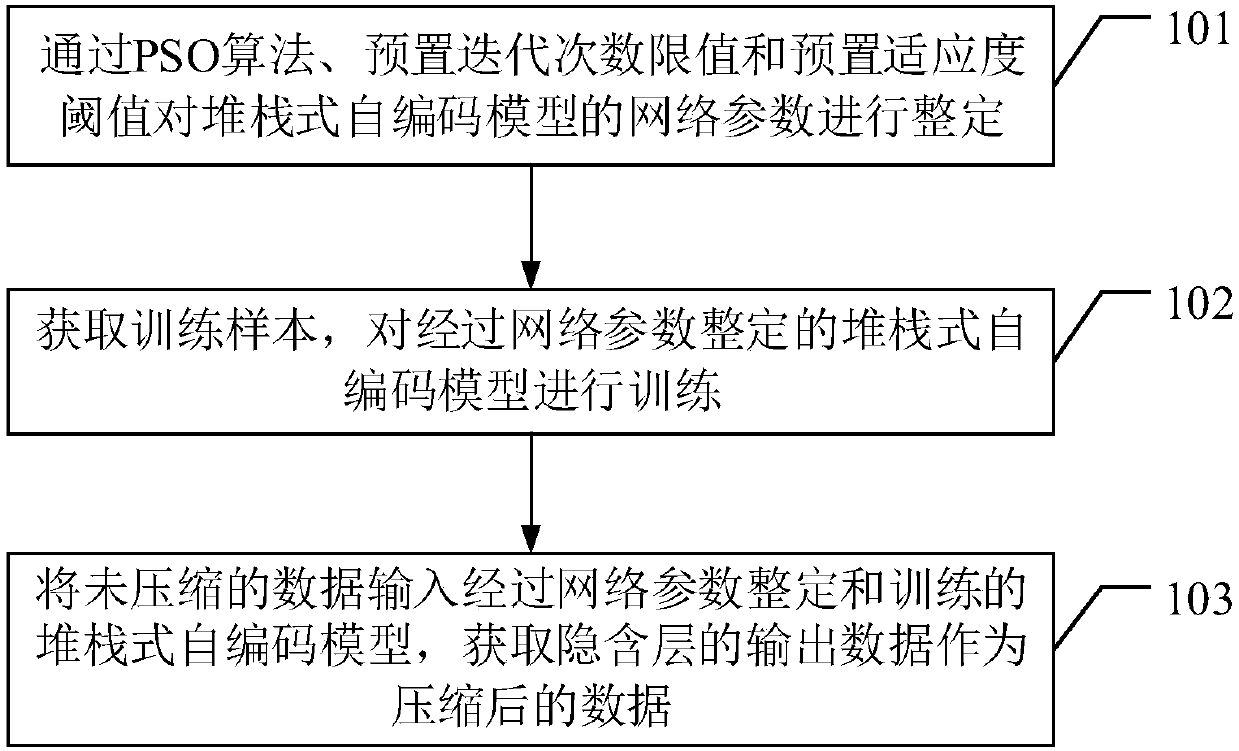

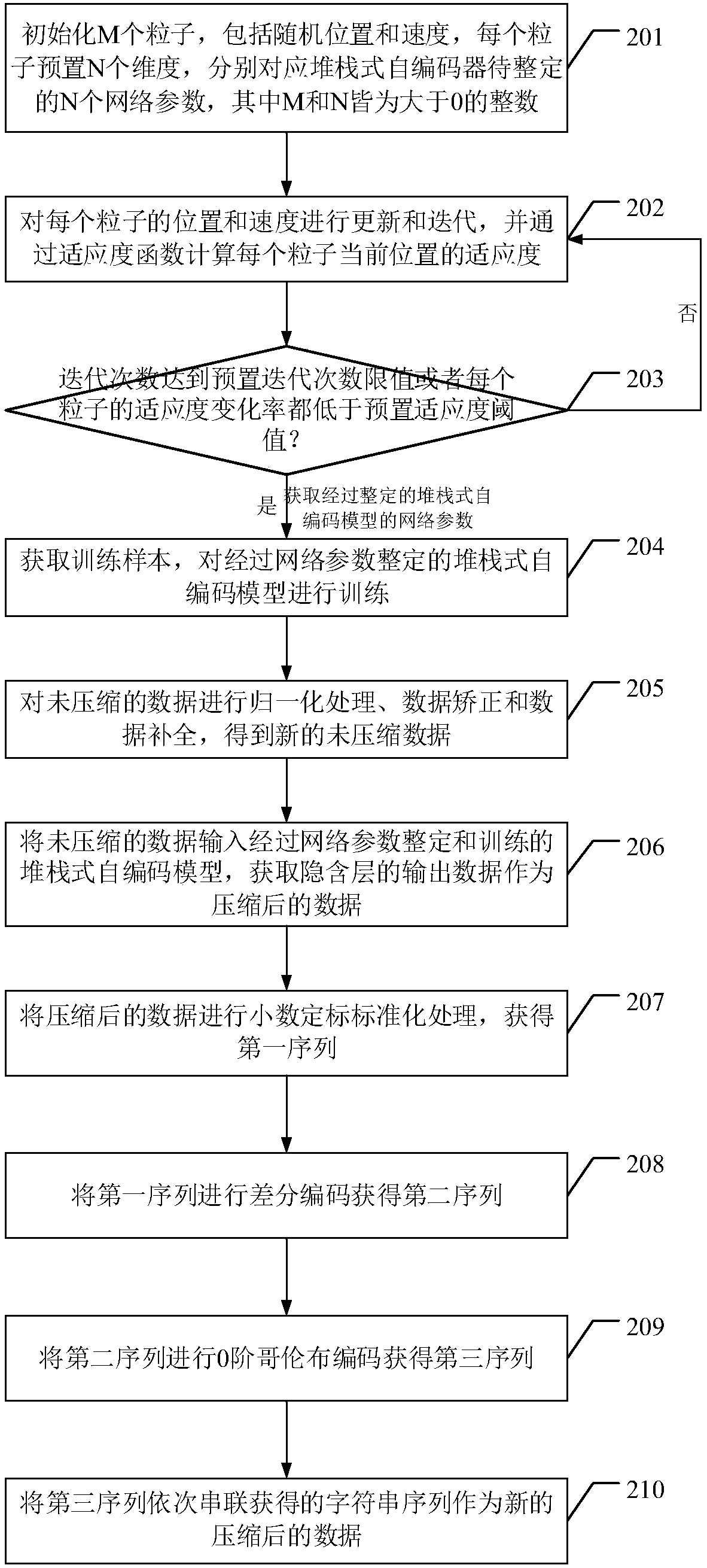

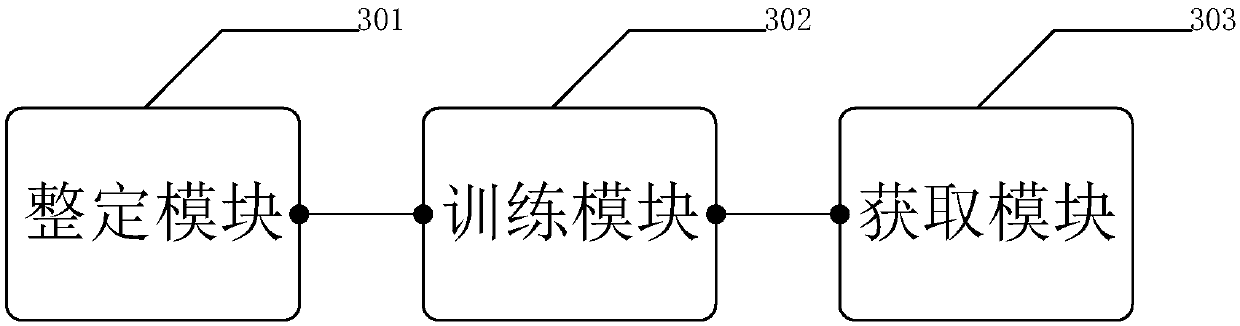

Data compression method and device based on stacking type self-coding and PSO algorithm

ActiveCN107749757AIncrease training speedStrong non-linear mapping abilityCode conversionNeural learning methodsData compressionOriginal data

The embodiment of the invention discloses a data compression method based on stacking type self-coding and a PSO algorithm. In the method, a stacking type self-coding model is a deep learning model, the training speed of a neural network can be improved by fine tuning of a layer-by-layer learning algorithm and an overall network weight, redundant information in data is removed, the most valuable information in the original data is extracted, and meanwhile the stacking type self-coding model is endowed with a good non-linear mapping capacity by a multi-layer network structure of the stacking type self-coding model; the stacking type self-coding model can be endowed with a weight applicable to expressing a sample via the fine tuning of the layer-by-layer learning algorithm and the overall network weight, the characteristics of the data are learned, the input data does not need to have a label, a network parameter of the stacking type self-coder is set via the PSO algorithm, the accuracyand searching speed are further improved, and the technical problems that when a shallow neural network is used for compressing the data at present, the convergence speed is slow, the non-linear mapping capability is poor and the input data needs to have the label are solved.

Owner:ELECTRIC POWER RES INST OF GUANGDONG POWER GRID +1

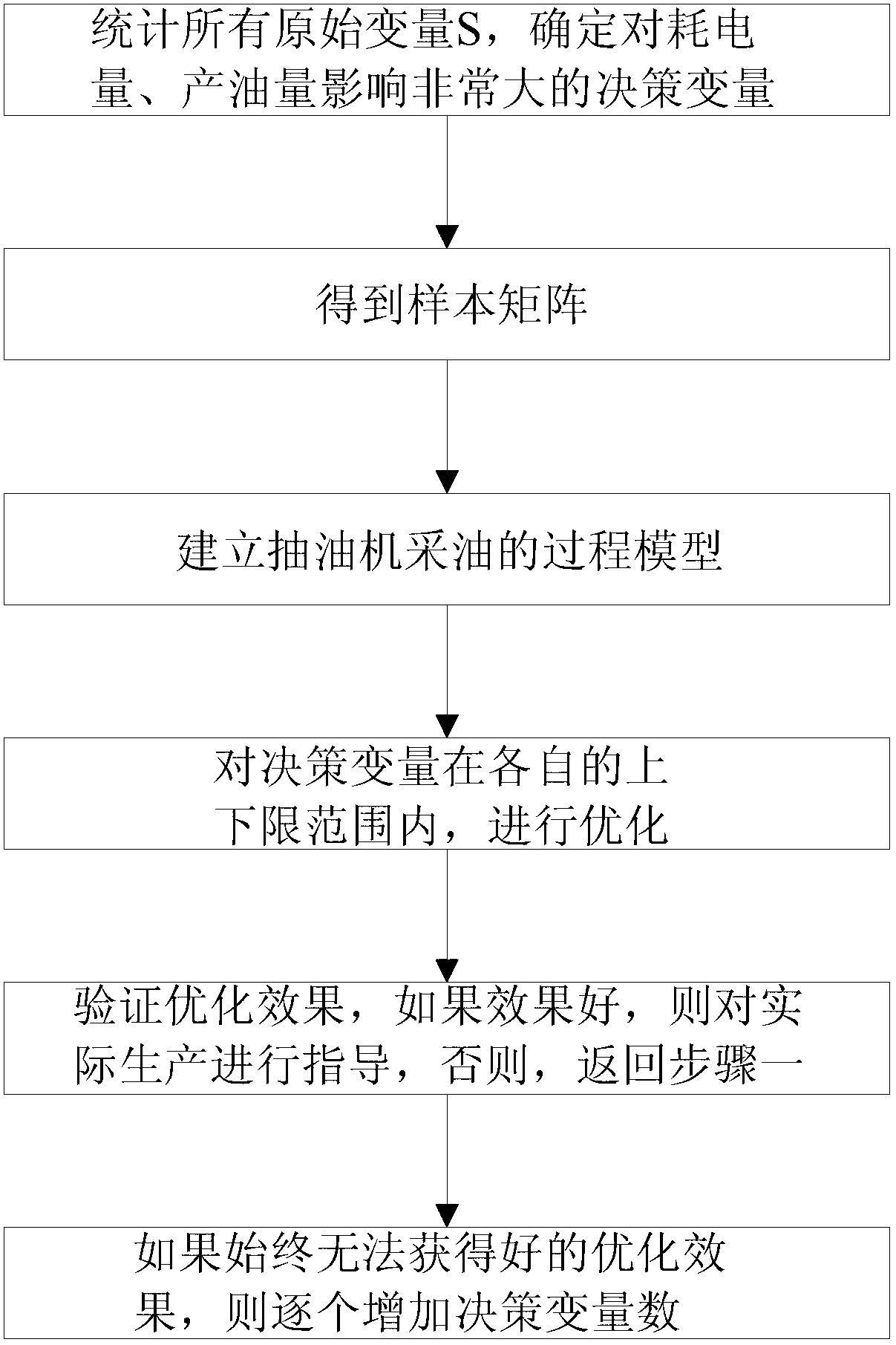

Oilfield pumping unit oil pumping energy saving and production increasing optimization method based on back propagation neural network (BPNN) and strength Pareto evolutionary algorithm 2 (SPEA2)

ActiveCN103177155AStrong non-linear mapping abilitySolve modeling problemsBiological neural network modelsSpecial data processing applicationsLower limitBack propagation neural network

The invention discloses an oilfield pumping unit oil pumping energy saving and production increasing optimization method based on the back propagation neural network (BPNN) and the strength Pareto evolutionary algorithm 2 (SPEA2). The method is characterized by including the following steps: step 1, calculating decision variables X; step 2, collecting samples of power consumption and samples of oil production Y to acquire a sample matrix; step 3, building a process model of oil pumping of a pumping unit; step 4, optimizing each decision variable in the range of an upper limit and a lower limit of each decision variable by using the SPEA2 based on a BPNN model; step 5, guiding actual production if the power consumption is reduced and the oil production is improved, and if not, returning the process to the step 1, changing S1 decision variables X on purpose and screening the decision variables X again; and step 6, assigning S1+1 to the S1, and returning the process to the step 1 if the combination of the set S1 decision variables X can not enable the power consumption to be reduced and the oil production to be improved. The oilfield pumping unit oil pumping energy saving and production increasing optimization method based on the BPNN and the SPEA2 has the advantages that an optimal value of technological parameters can be determined, and actual production guiding can be carried out according to the optimized technological parameter optimal value.

Owner:CHONGQING UNIVERSITY OF SCIENCE AND TECHNOLOGY

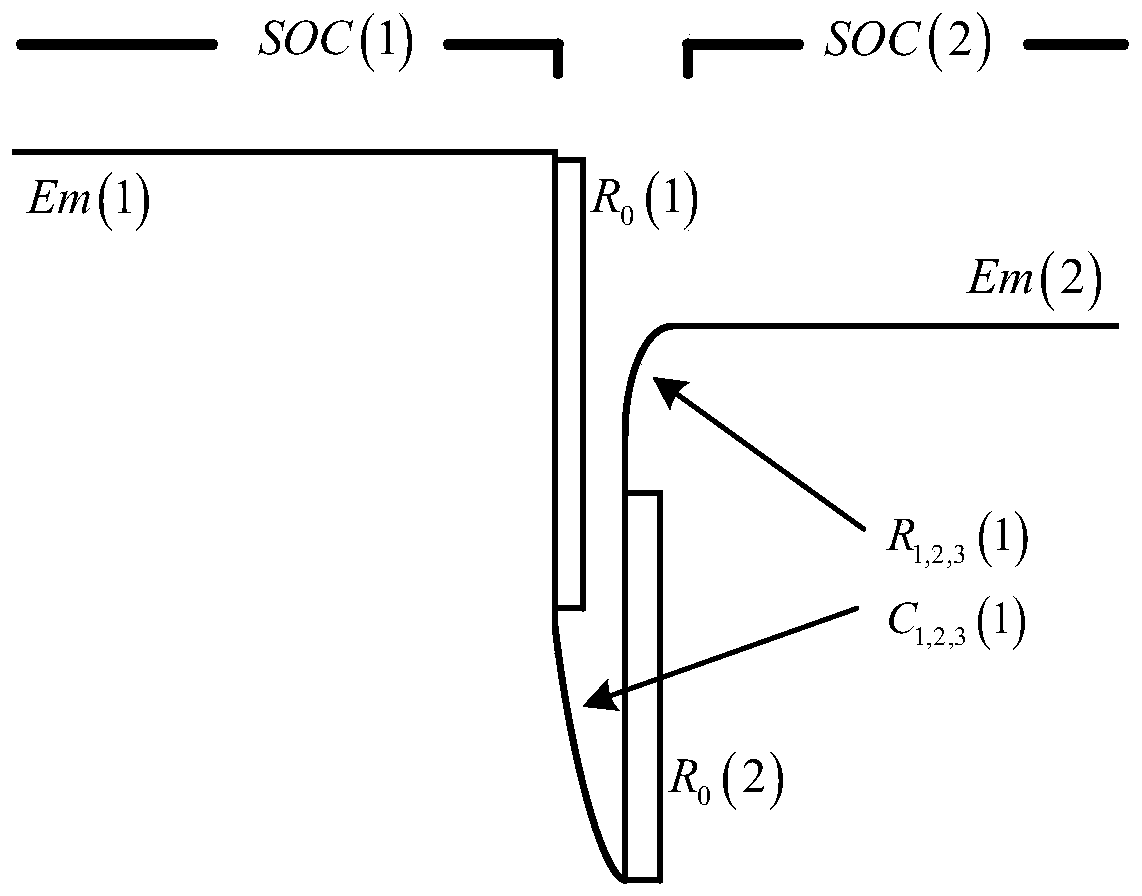

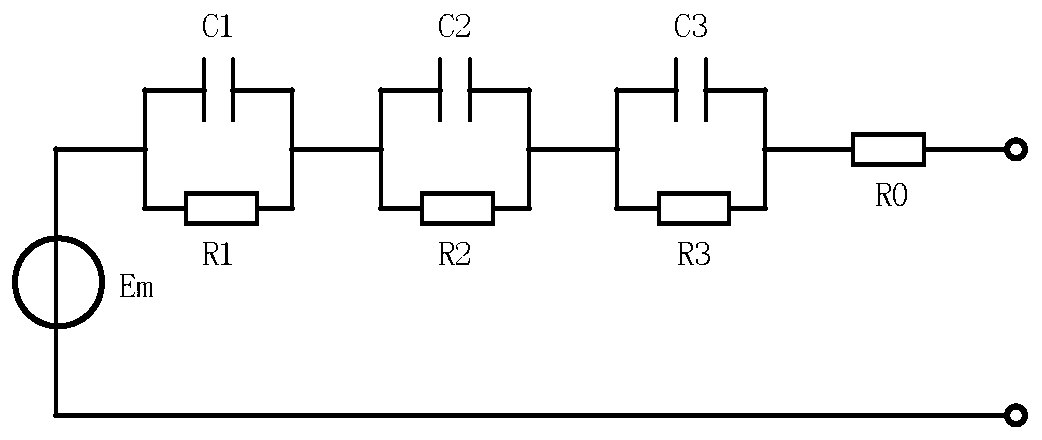

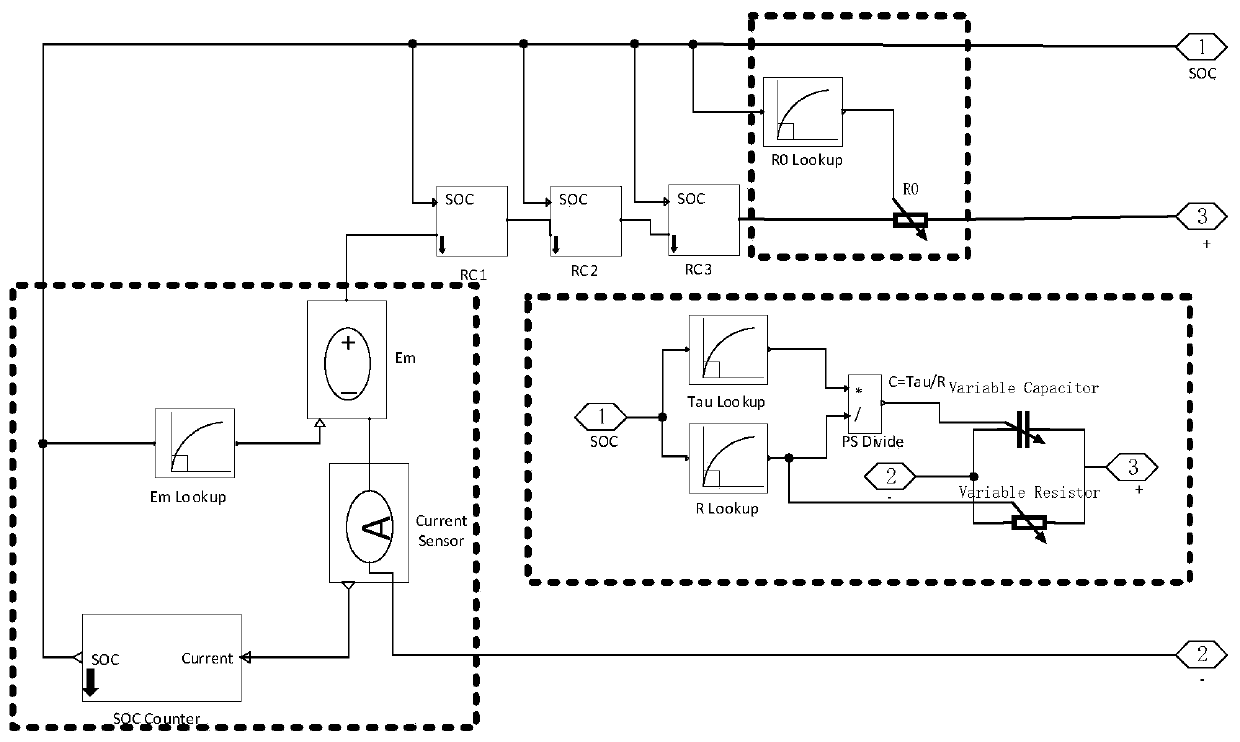

Method for estimating state of health (SOH) of lithium battery based on grey neural network

InactiveCN110058159AStrong non-linear mapping abilityAvoid calculationElectrical testingBattery terminalElectrical battery

The invention discloses a method for estimating the state of health (SOH) of a lithium battery based on a grey neural network. The method of the invention includes the following steps of: respectivelyperforming constant-current discharge and pulse discharge on the battery, and recording battery capacity data in the constant-current discharge process and the battery terminal voltage and dischargecurrent in the pulse discharge process of the battery; analyzing the characteristics of the battery terminal voltage, and building a third-order RC model in Simscape as an equivalent circuit model ofthe battery; automatically estimating internal impedance parameters of the battery through the battery model; constructing a battery SOH estimation model combining the grey theory with a neural network, and training the model according to the recorded internal impedance parameters of the battery and the battery capacity; and estimating the battery capacity by the model, and further calculating theSOH of the battery. The method of the invention can adapt to the highly nonlinear characteristics of an electrochemical system of the battery, and has the advantages of small data calculation amount,less required sample data, high prediction accuracy and the like.

Owner:HANGZHOU DIANZI UNIV

Process optimization method of steel/aluminum laser welding brazing

InactiveCN102999676AStrong non-linear mapping abilityExcellent self-learning performanceNeural learning methodsSpecial data processing applicationsElement analysisArtificial neural network

The invention discloses a process optimization method of steel / aluminum laser welding brazing. The process optimization method comprises the following steps of: simulating a steel / aluminum laser welding brazing process under specific conditions by virtue of software of finite element analysis; establishing a mapping relation between each process parameter and each fusion depth by virtue of an artificial neural network, and predicating the fusion depths under the different process parameters; and acquiring an ideal welding line fusion depth under the condition of comprehensively considering condensation and contraction of a welding line so as to obtain better process parameters. The process optimization method is applied to selection of the process parameters of the steel / aluminum laser welding brazing, has a certain guidance meaning on the selection of the process parameters of the steel / aluminum laser welding brazing in production practice by virtue of organic combination of computer stimulation and predication technologies, and can overcome the difficulty in the selection of the process parameters of the steel / aluminum laser welding brazing by experience and a lot of experiments so as to improve production efficiency and production quality and save production costs.

Owner:HUNAN UNIV

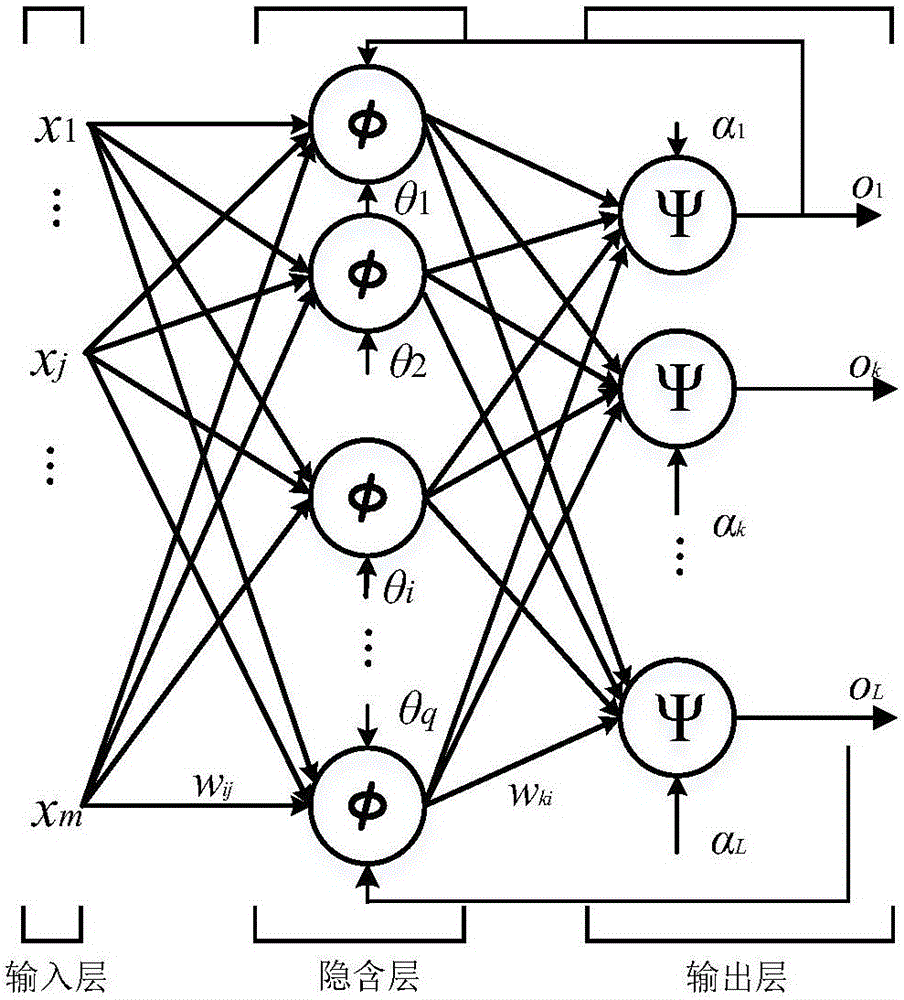

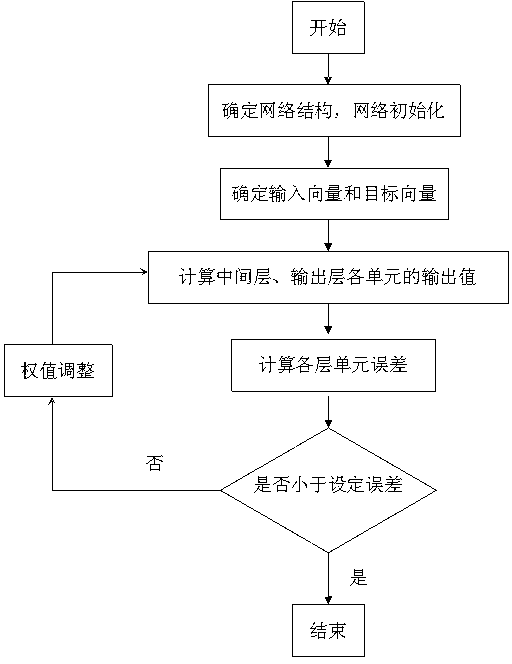

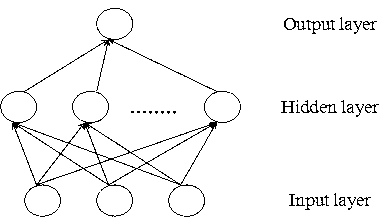

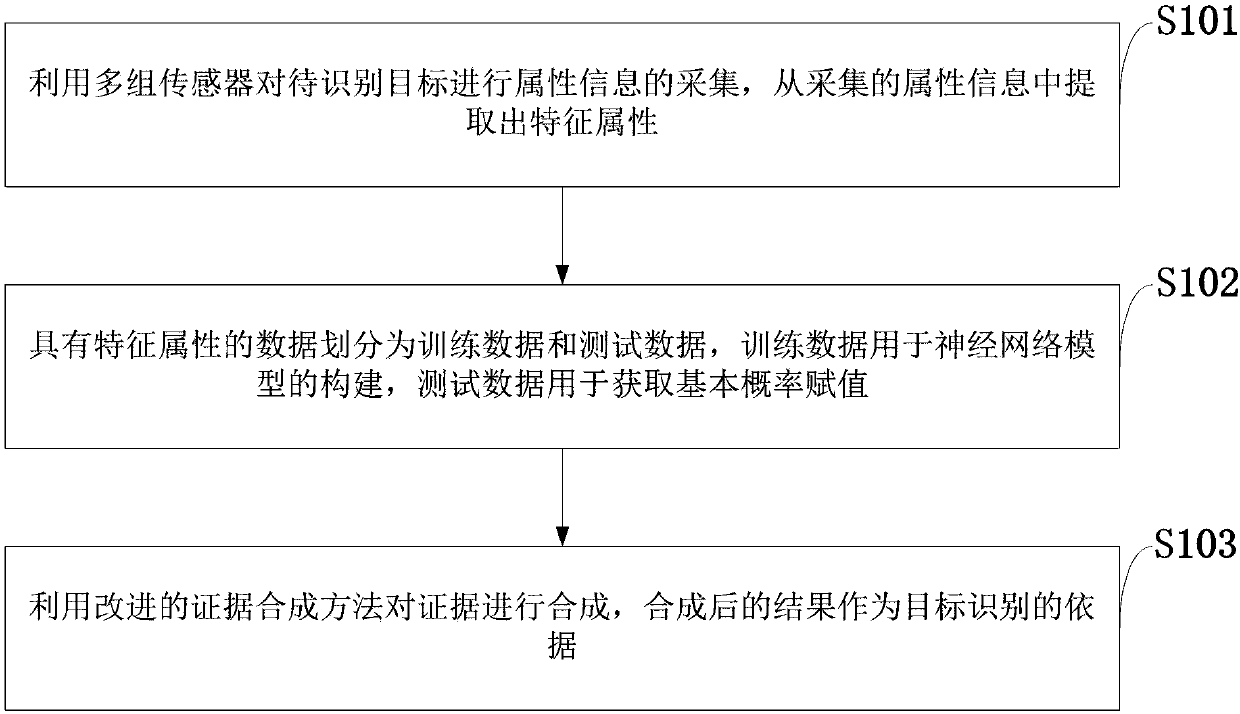

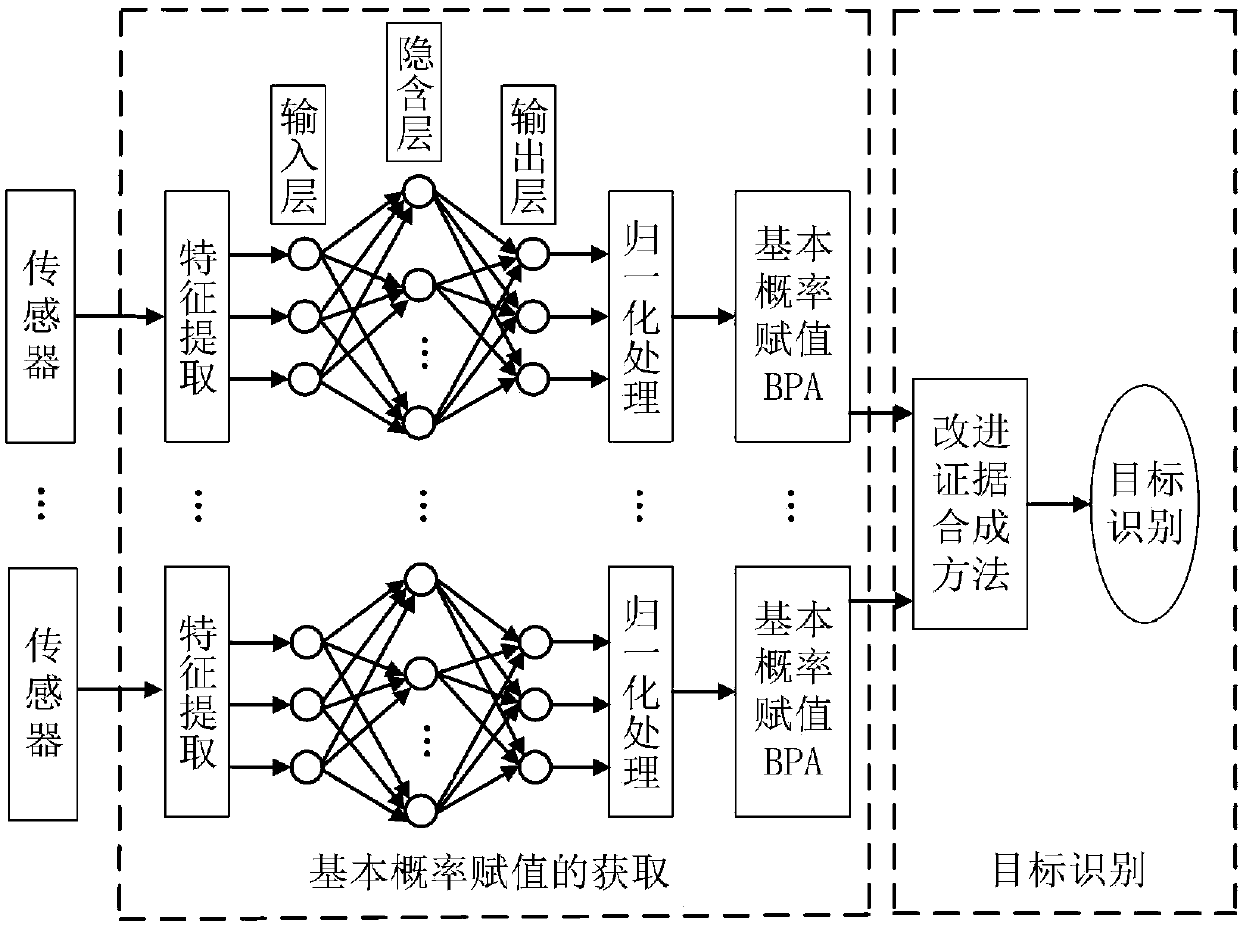

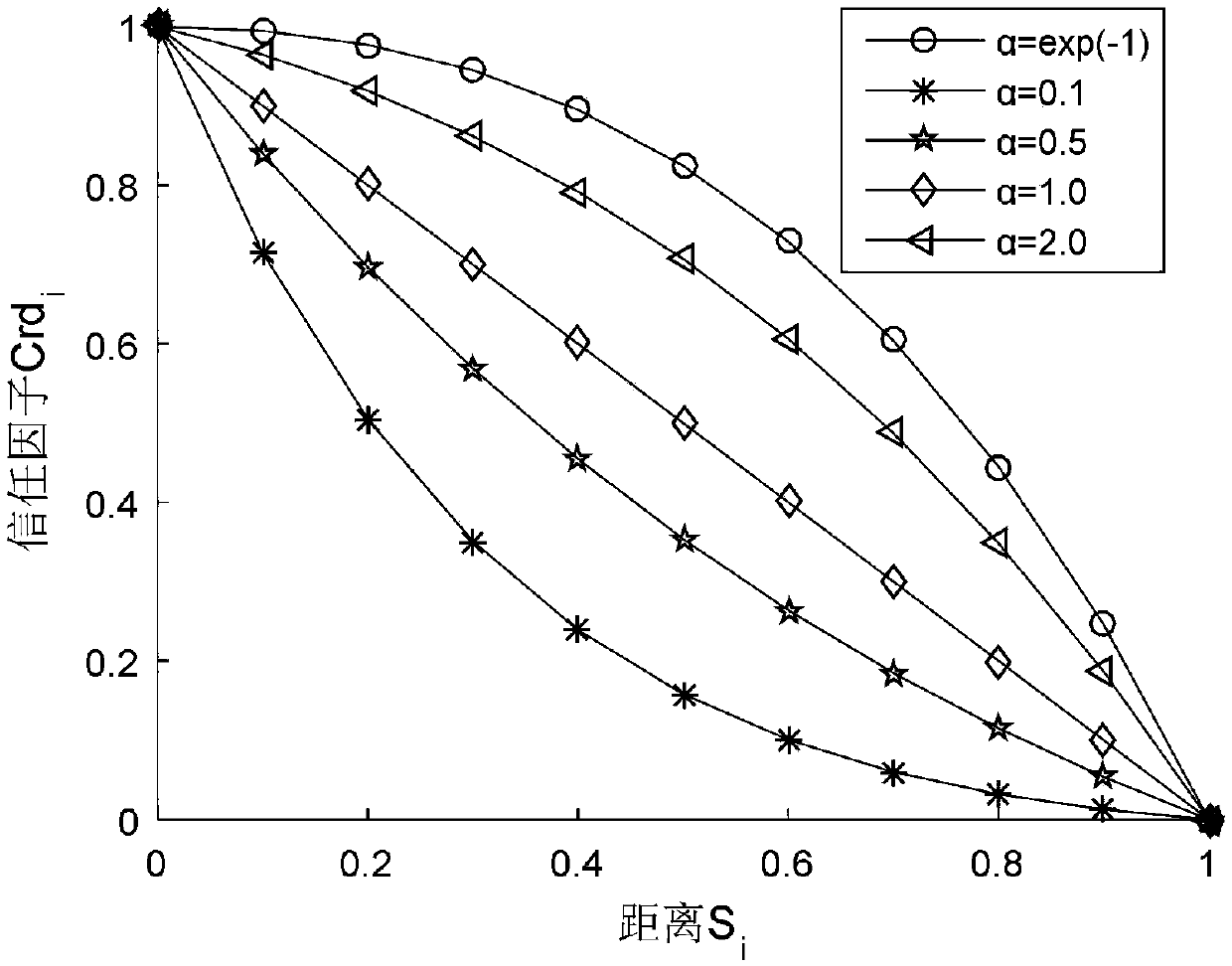

Evidence-synthesis-based information-fusion target recognition method

InactiveCN107622275ALow trust factorHigh trust factorCharacter and pattern recognitionNeural architecturesGoal recognitionNetwork model

The invention, which belongs to the technical field of multi-sensor information fusion, discloses an evidence-synthesis-based information-fusion target recognition method. A plurality of sensors are used for carrying out attribute information collection on a to-be-identified target and a feature attribute is extracted from the collected attribute information; data having the feature attribute aredivided into training data and testing data, wherein the training data are used for constructing a neural network model and the testing data are used for obtaining a basic probability assignment value; and then evidences are synthesized based on an improved evidence synthesis method and the synthesized result is used as the target recognition basis. According to the invention, the basic probability assignment values of evidences are obtained accurately and a synthesis problem of high-conflict evidences is solved. The basic probability assignment values of evidences are obtained by using the neural network and the neural network has the high nonlinear mapping capability and is capable of mapping the intrinsic relationship between the target feature data, so that the accuracy of the basic probability assignment values is ensured, the conformance to the real scene is realized, and the practical significance is good.

Owner:XIDIAN UNIV +1

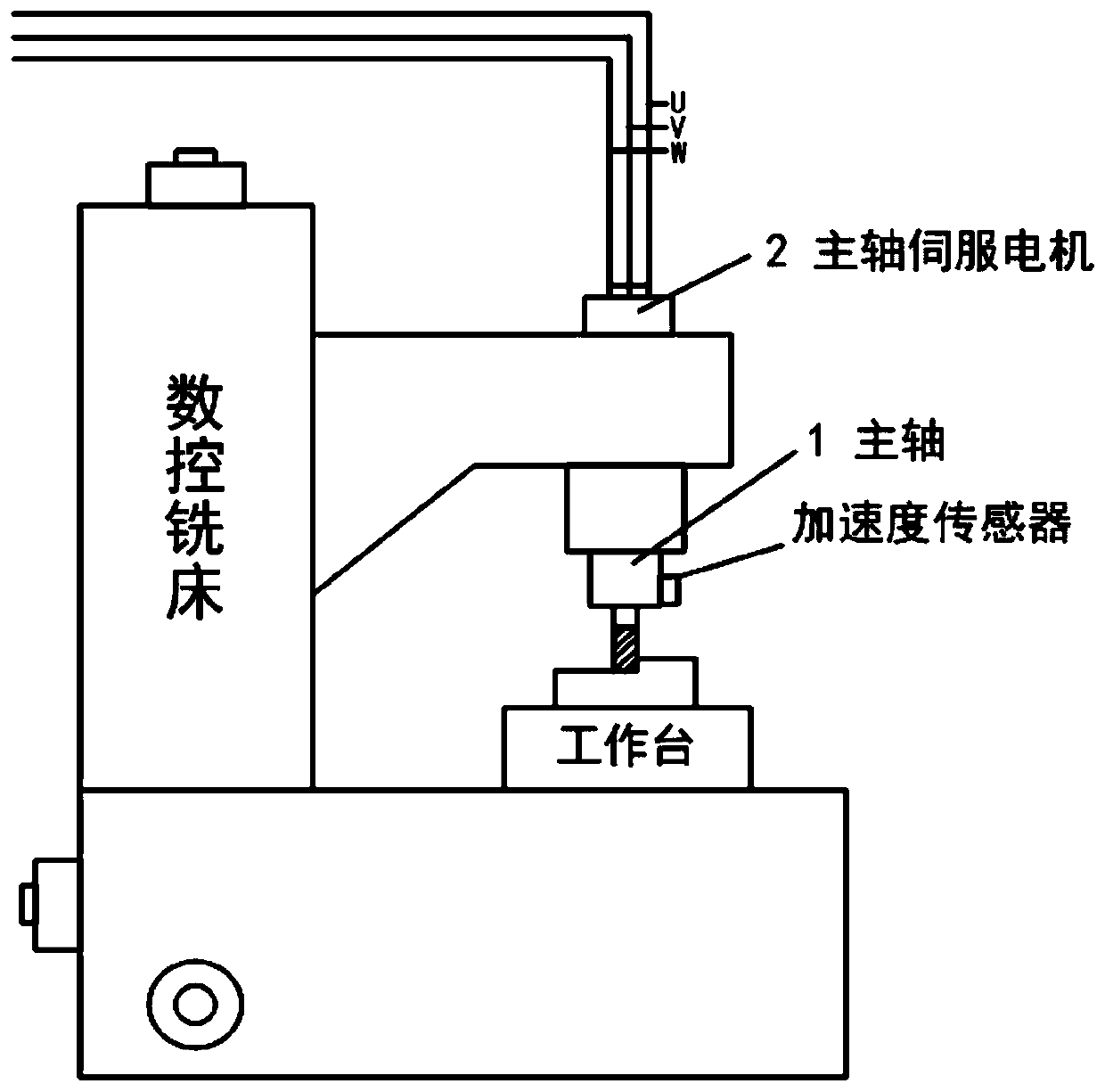

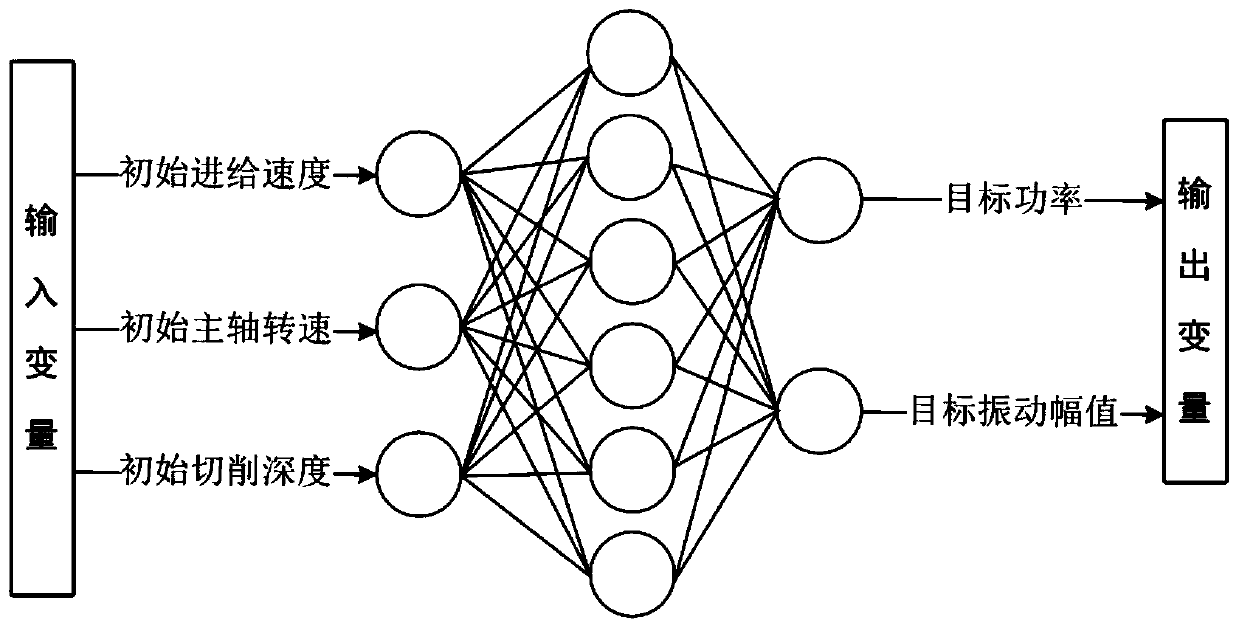

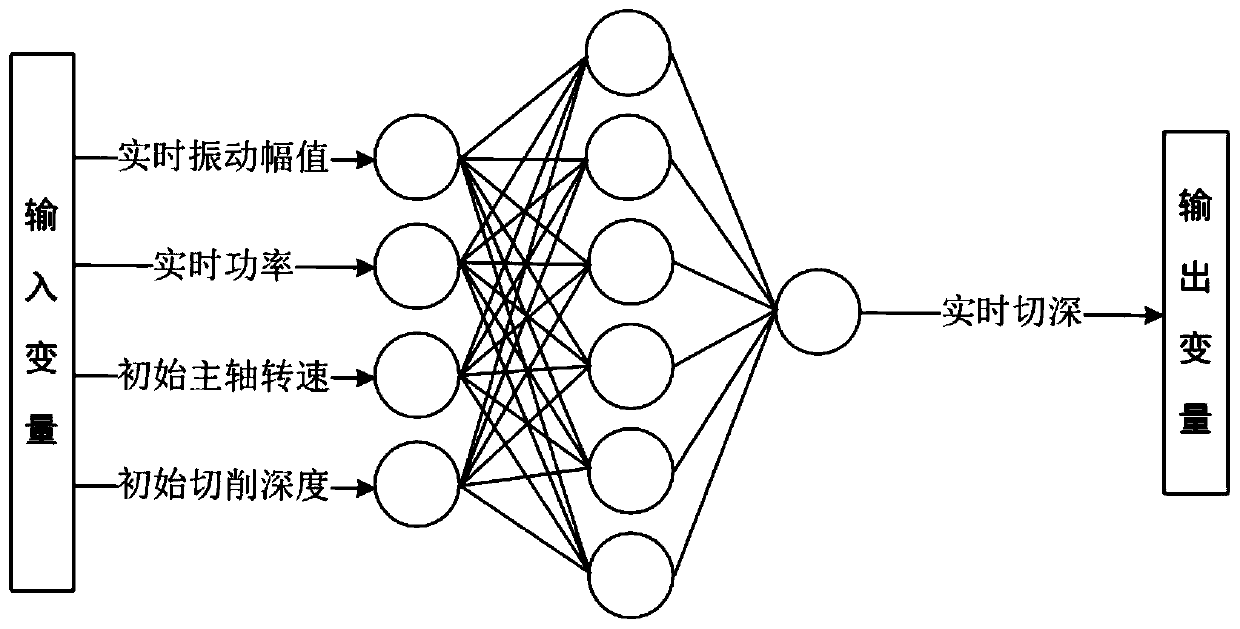

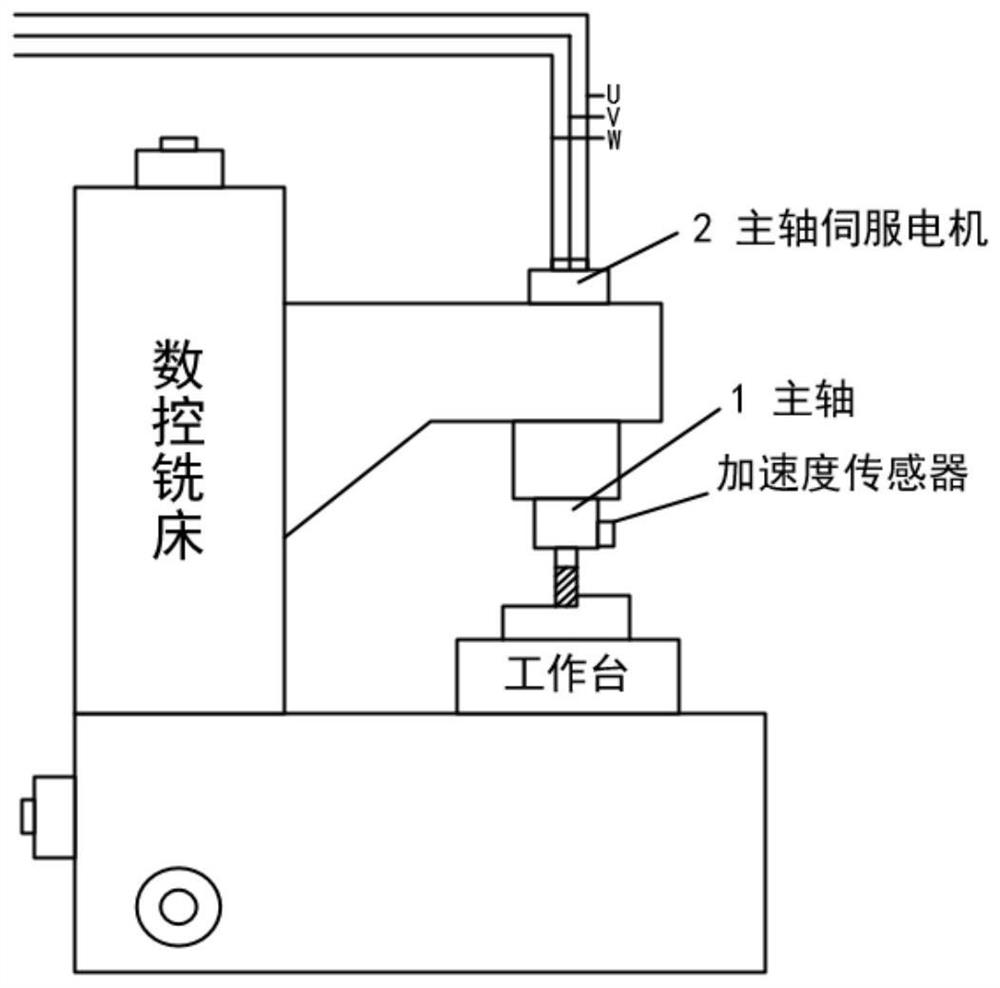

Adaptive machine tool control method based on GA-BP neural network algorithm

ActiveCN110488754AImprove processing efficiencySave production time and costProgramme controlComputer controlNumerical controlMachine tool control

The invention discloses a machine tool self-adaptive control method based on a GA-BP neural network algorithm, and belongs to the technical field of numerical control machining. The method comprises the steps that a spindle motor power signal and a spindle vibration signal in the workpiece numerical control machining process are monitored in real time, and the feeding speed and the spindle rotating speed are optimized in real time and adjusted adaptively based on the spindle power signal and the spindle vibration signal; and the whole signal acquisition process does not influence normal processing. The machine tool self-adaptive control method based on the neural network algorithm can be used to effectively improve the machining efficiency and the machining quality, prolong the service life of a cutter and a machine tool and reduce the cost.

Owner:DALIAN UNIV OF TECH

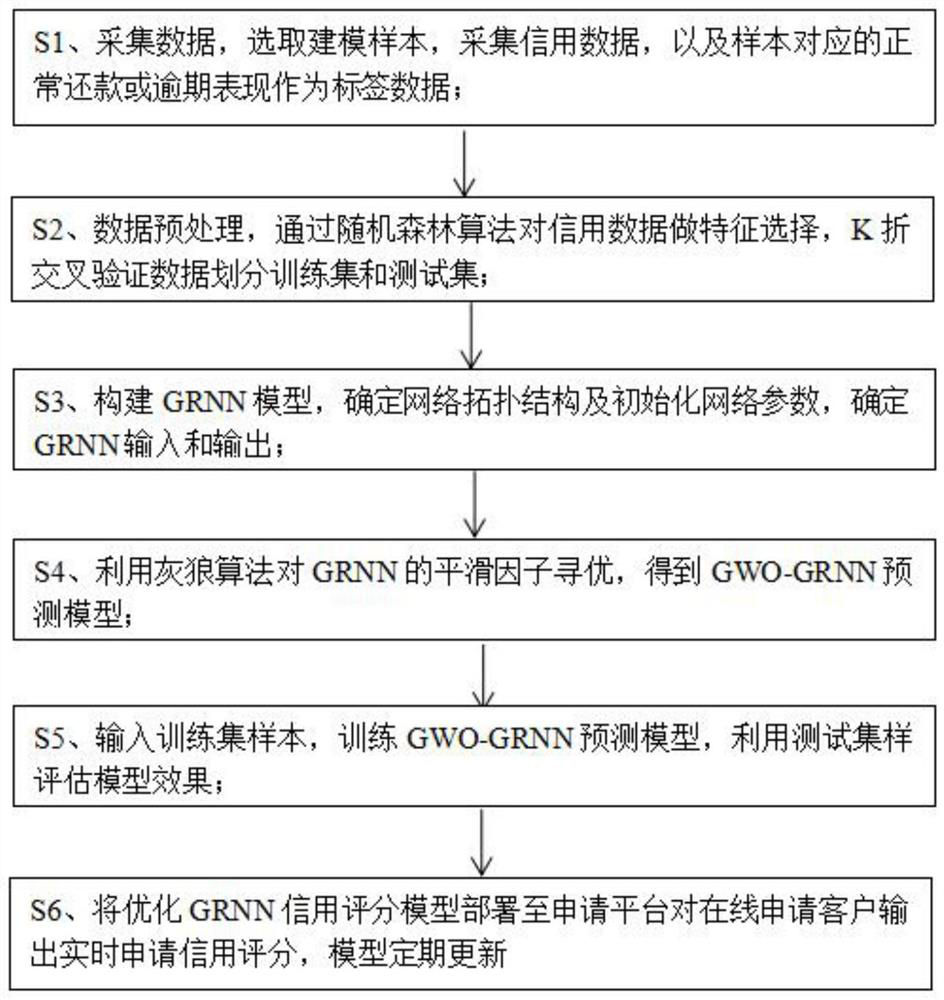

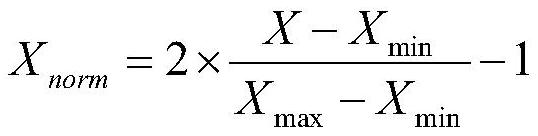

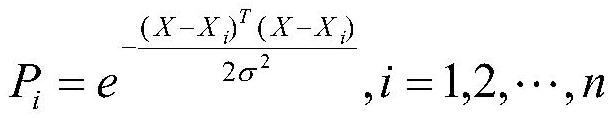

Credit evaluation method for optimizing generalized regression neural network based on grey wolf algorithm

InactiveCN112581263AStrong non-linear mapping abilityApproximation effect is goodFinanceForecastingRisk ControlThe Internet

The invention relates to the technical field of risk control of the Internet financial industry, in particular to a credit evaluation method for optimizing a generalized regression neural network based on a grey wolf algorithm. The method comprises six steps, and compared with common BP and RBF neural networks, the method has the advantages that GRNN selected by the method is strong in nonlinear mapping capability, good in approximation performance and suitable for processing unstable data. The method has the advantages of being good in generalization ability, high in fitting ability, high intraining speed, convenient in parameter adjustment and the like, and compared with common optimization algorithms such as genetic algorithms and particle swarms, the grey wolf algorithm is few in parameter and simple in programming, and has the advantages of being high in convergence speed, high in global optimization ability, potential in parallelism, easy to implement and the like. The grey wolfalgorithm is adopted to optimize the GRNN network model, the prediction precision and stability are high, the defects that the GRNN prediction result is unstable and is very likely to fall into the local minimum value are effectively avoided, and rapid and accurate online real-time prediction of the credit score of the application user is achieved.

Owner:百维金科(上海)信息科技有限公司

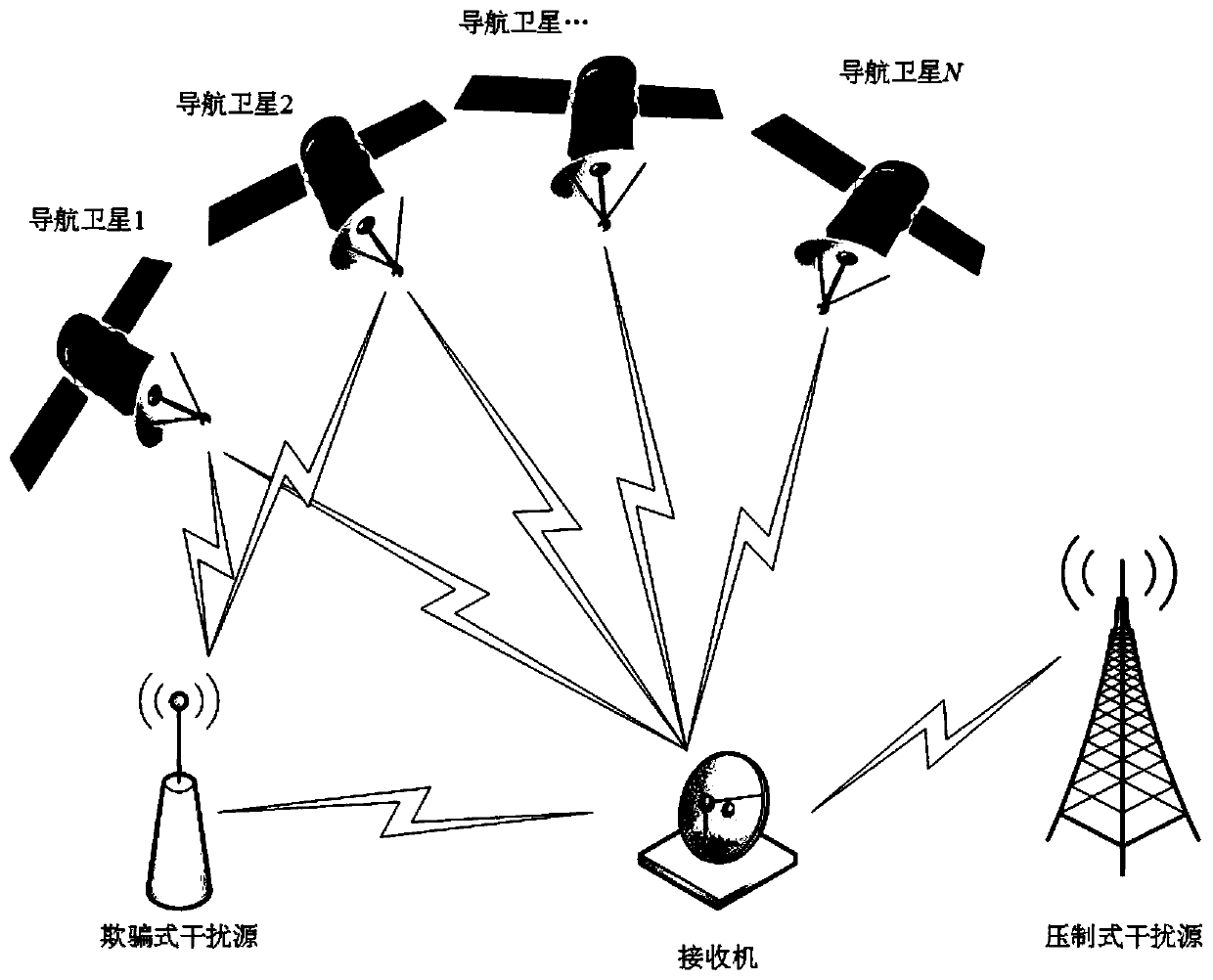

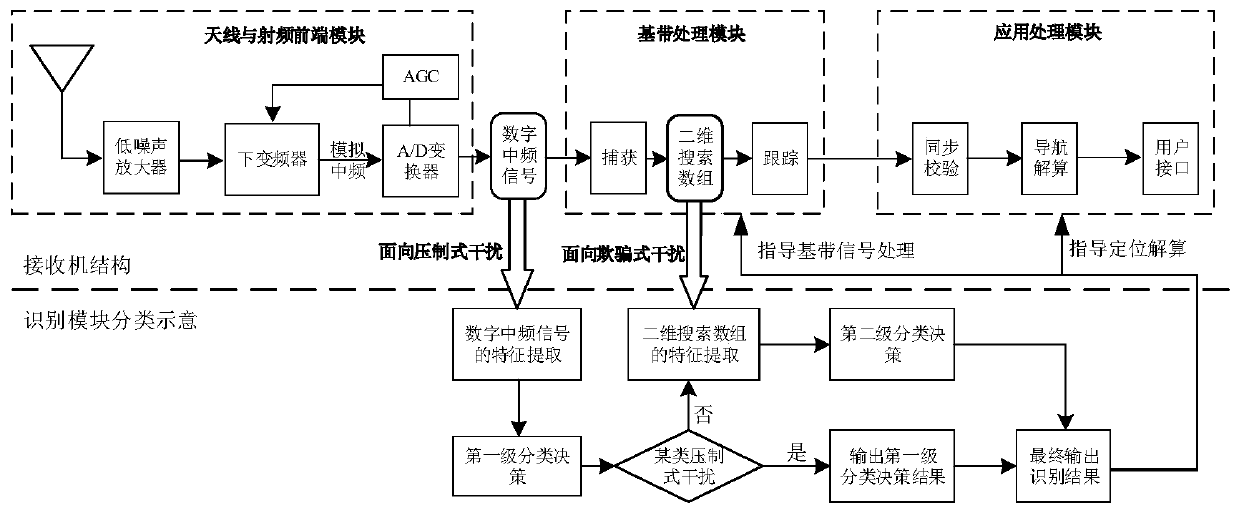

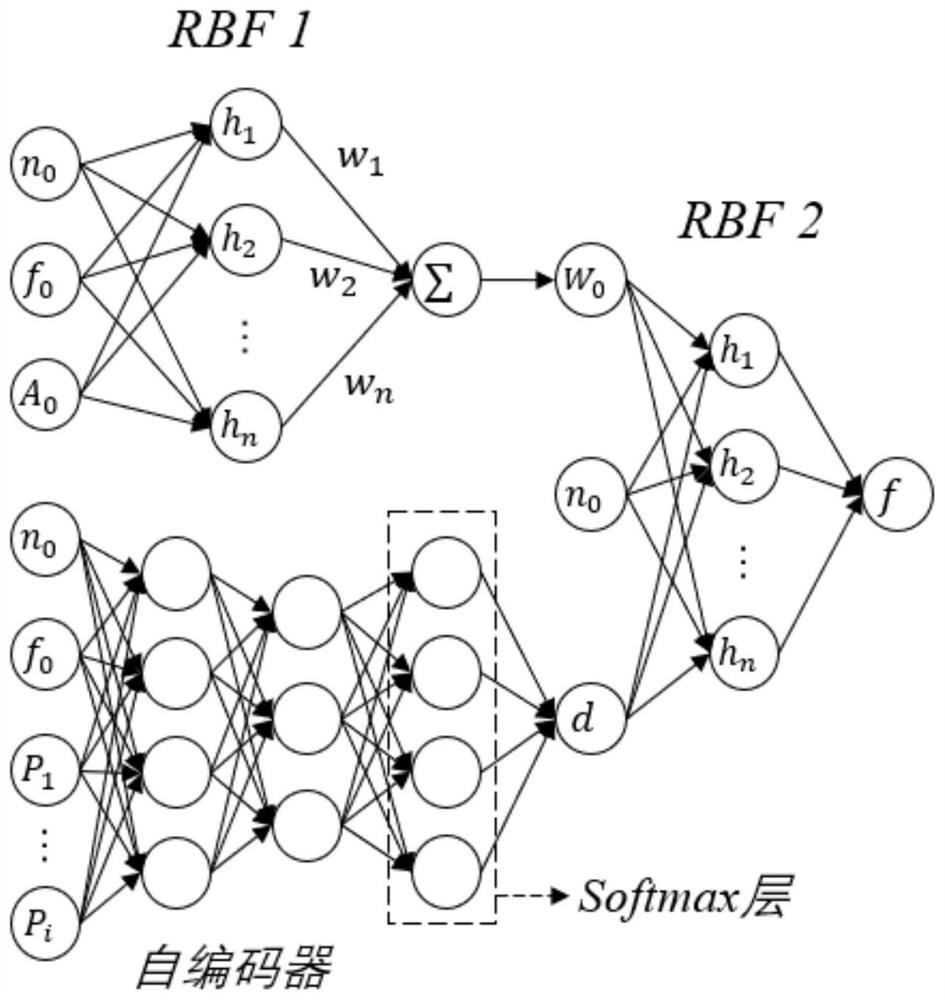

GNSS receiver combined interference classification and identification method based on two-stage neural network

ActiveCN111399002AImprove recognition rateGood effectCharacter and pattern recognitionSatellite radio beaconingTime domainDigital intermediate frequency

The invention discloses a GNSS receiver combined interference classification and identification method based on a two-stage neural network. A receiver receives navigation signals sent by N visible satellites; according to a received GNSS signal model and interference source, a two-stage identification scheme based on a BP neural network is adopted to extract time domain and frequency domain characteristics of a digital intermediate frequency signal after A / D conversion through a first-stage identification module, and the time domain and frequency domain characteristics are sent to the BP neural network for suppressing interference detection and classification; if an identification result of the first-stage recognition module is that there is no interference or deception jamming, the digital intermediate frequency signal is captured, related peak characteristics are extracted by using a captured two-dimensional search matrix, and the related peak characteristics are sent to the second-stage recognition module for deception jamming detection; and when a final identification result of the two stages of identification modules is that there is no interference, it is determined that thereceived signal is a real satellite signal, and after the interference type is identified, a corresponding interference processing means is adopted. The method can be used to quickly and accurately identify interference.

Owner:XI AN JIAOTONG UNIV

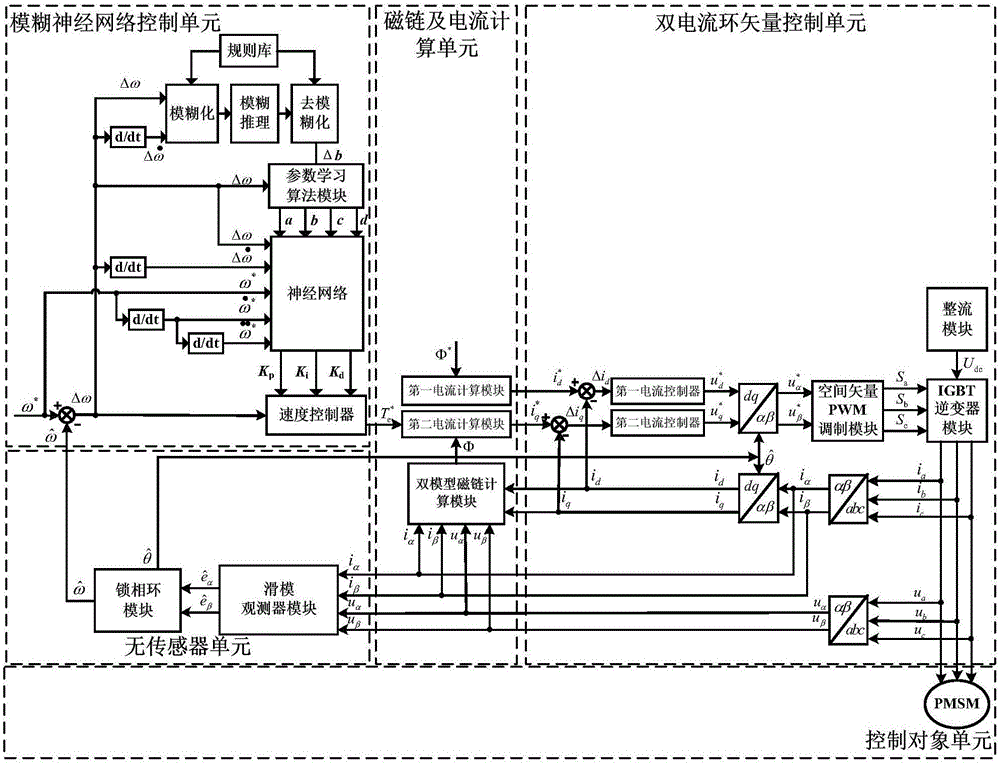

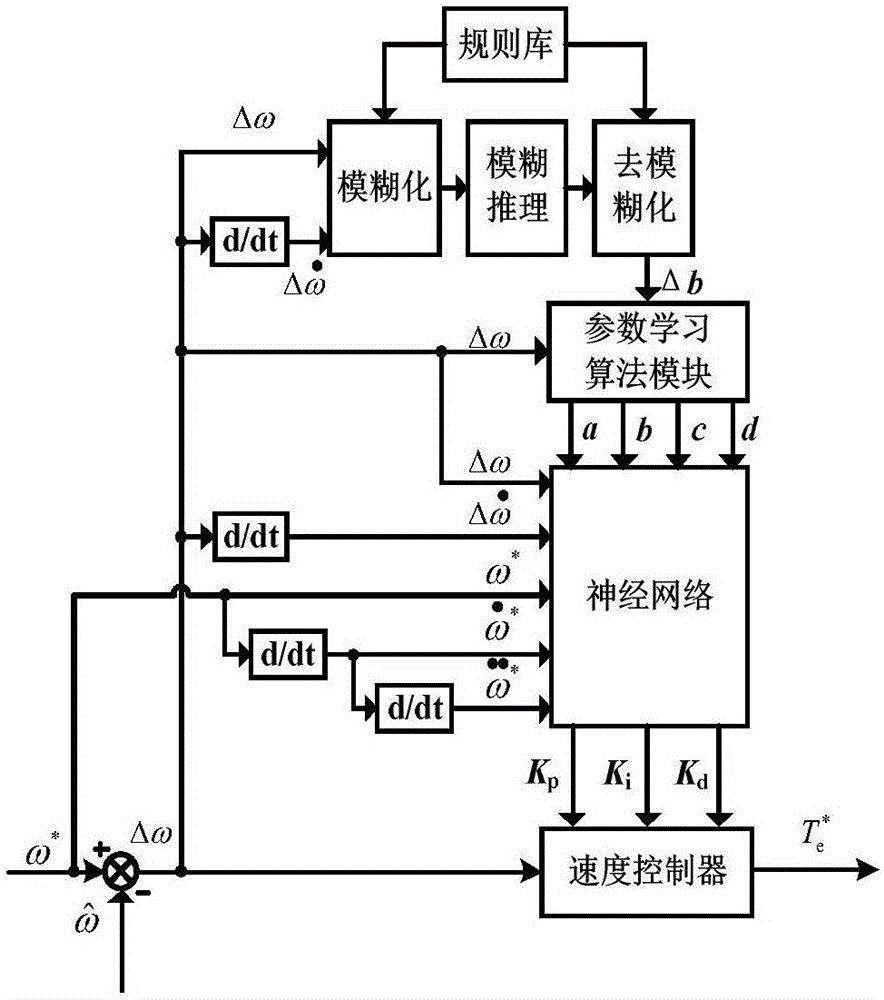

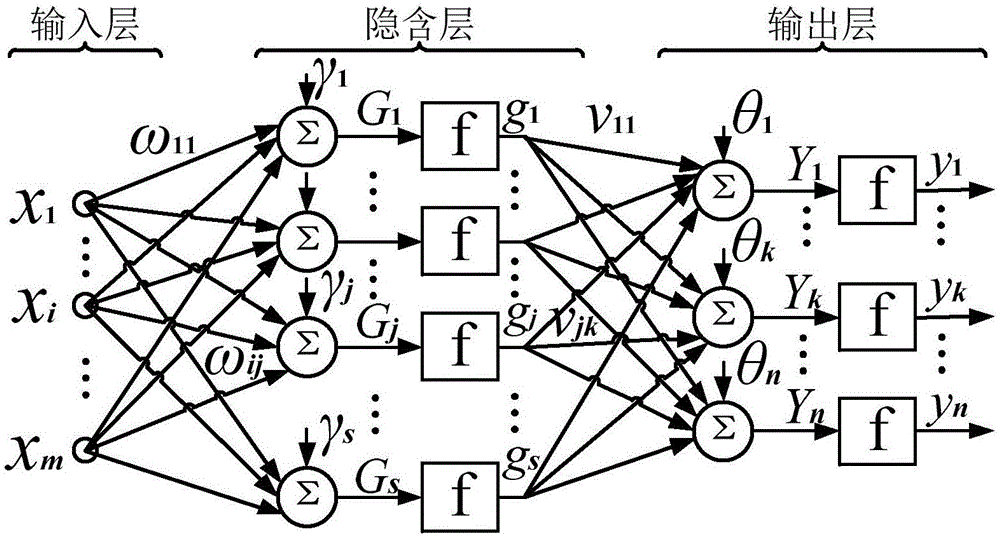

Permanent magnet synchronous motor fuzzy neural network control system for electric car

ActiveCN106849793AHigh precisionImprove stabilityElectronic commutation motor controlElectric motor controlDifferentiatorPermanent magnet synchronous motor

The present invention discloses a permanent magnet synchronous motor fuzzy neural network control system for an electric car, relates to an electrical transmission and control technology field, and provides a speed controller based on the fuzzy mathematics and neural network theory and a novel sliding-mode observer based on a tracking differentiator. The system comprises a fuzzy neural network control unit, a sensorless unit, a flux linkage and current calculation unit, a dual- current-loop vector control unit and a control object unit, can realize parameter autotuning of the permanent magnet synchronous motor and high-precision speed regulation in the condition without a mechanical speed sensor, can be applied on an electric car taking the permanent magnet synchronous motor as a power device, and is simple in structure and reliable in operation. Compared to a traditional PID speed controller and a sliding-mode observer, the permanent magnet synchronous motor fuzzy neural network control system for an electric car is higher in tracking precision, stronger in robustness and smaller in counter electromotive force buffeting; and when parameter perturbation of the controller or load disturbance, the permanent magnet synchronous motor fuzzy neural network control system for the electric car also can perform online regulation of parameters of the controller and accurately estimate the position and the speed of a motor rotor.

Owner:XI AN JIAOTONG UNIV

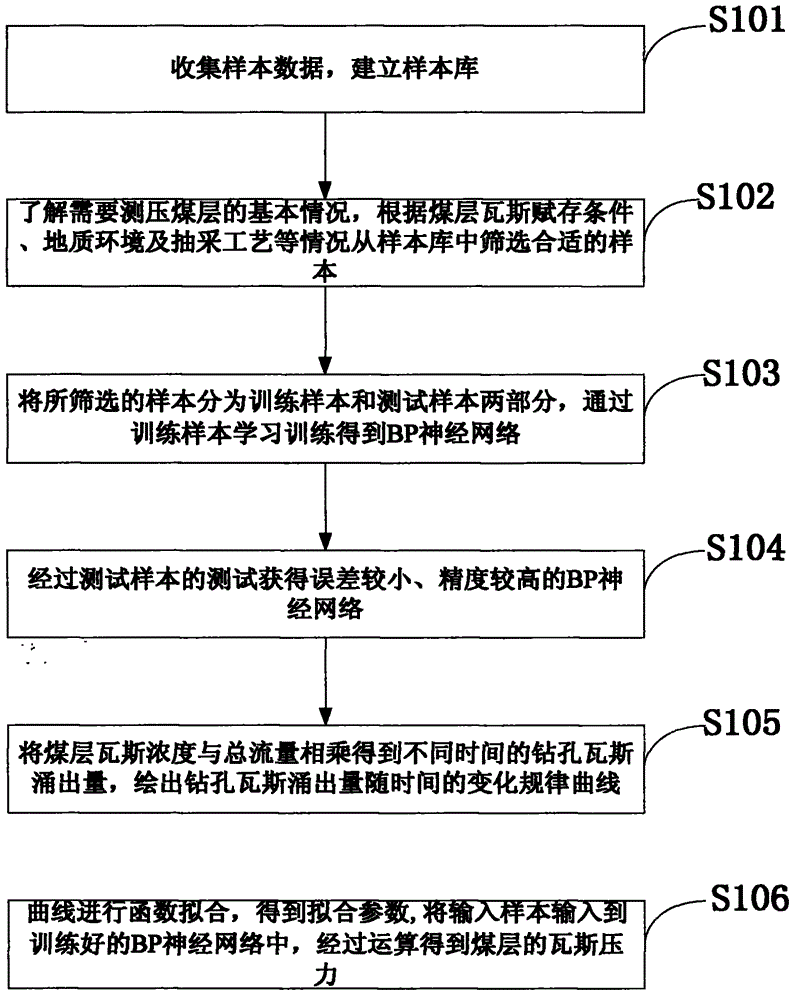

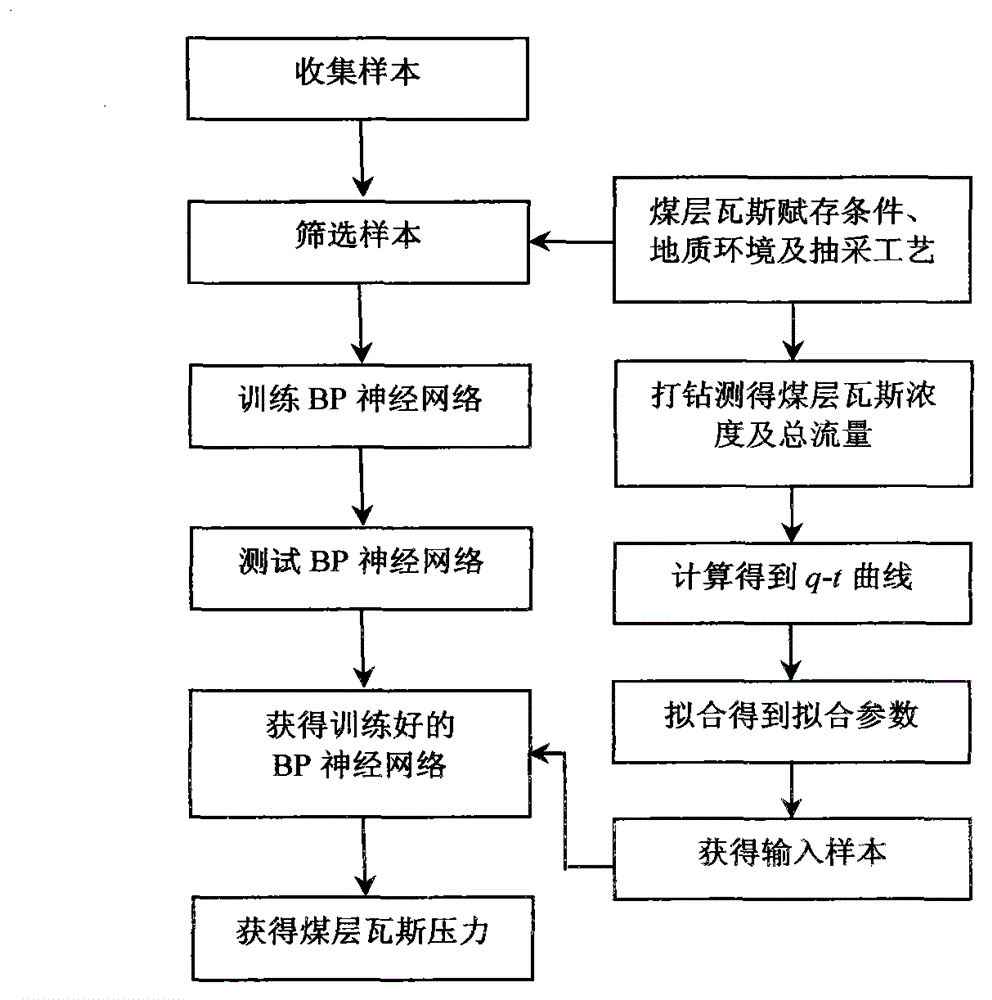

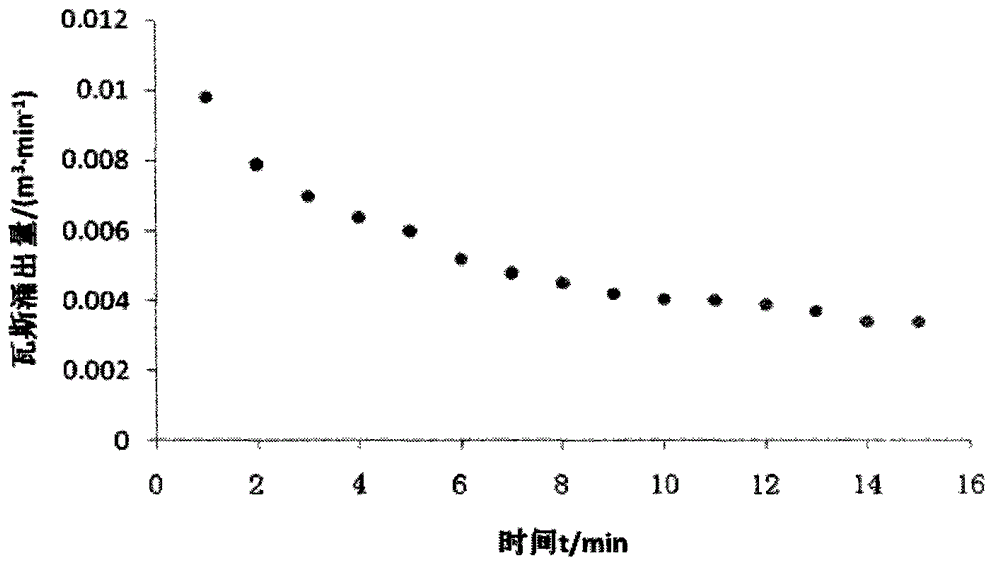

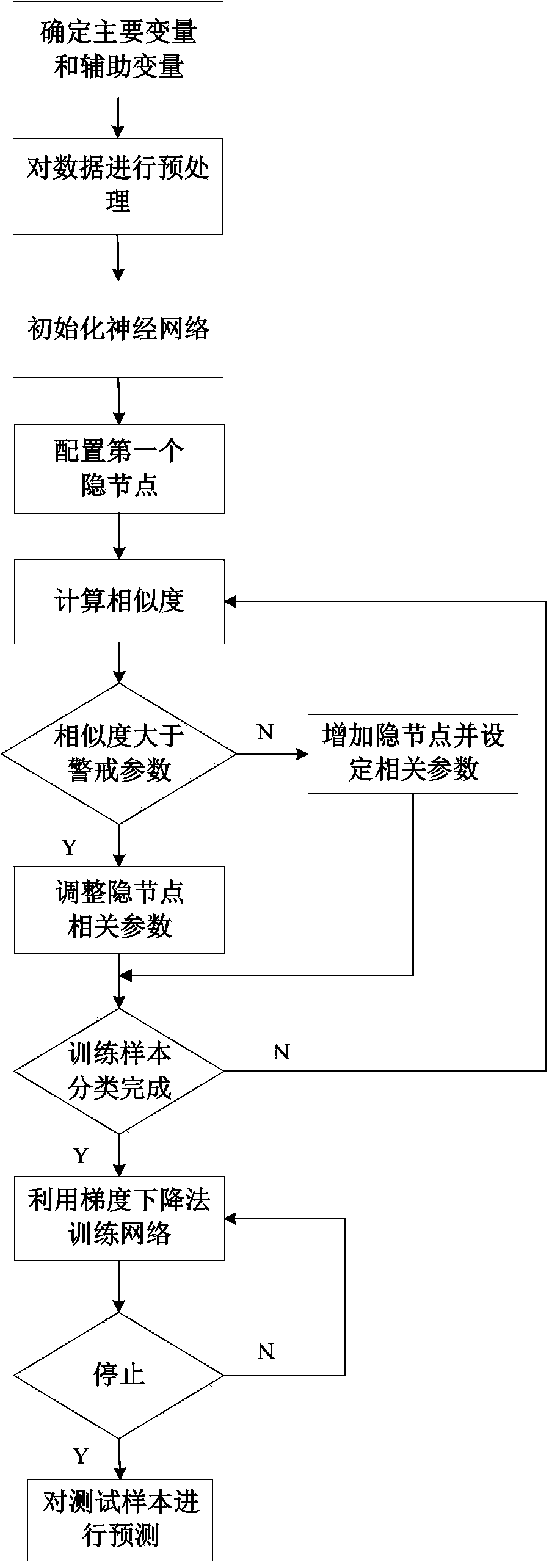

Method and device for determining gas pressure of coal seam

The invention discloses a method and a device for determining gas pressure of a coal seam. The method comprises the following steps: at an initial stage after hole drilling and hole sealing, a drilled hole gas emission rate q meets a power function relation along with time t, namely q=At-B; in the formula, a drilled hole gas emission initial speed A and an attenuation coefficient B are parameters which are changed along with the change of the gas pressure of the coal seam; and a relation is utilized to carry out rapid inversion on the gas pressure of the coal seam through a BP neural network. According to the device for determining the gas pressure disclosed by the invention, an air inlet pipe, a yellow mud hole sealing opening and an air guide pipe are arranged in a measuring room; a flow sensor is connected with the air guide pipe, a vacuum pump and a gas concentration sensor; an air outlet pipe is mounted on the vacuum pump; a signal conditioning circuit is connected with the flow sensor and the gas concentration sensor; an A / D (Analogue / Digital) converter is connected with the signal conditioning circuit; and a PC (Personal Computer) is connected with the A / D converter. The method and the device disclosed by the invention have the characteristics of solving the difficulty that the height of a function relationship for indirectly determining the gas pressure of the coal seam, and having fast inversion.

Owner:SHANDONG UNIV OF SCI & TECH

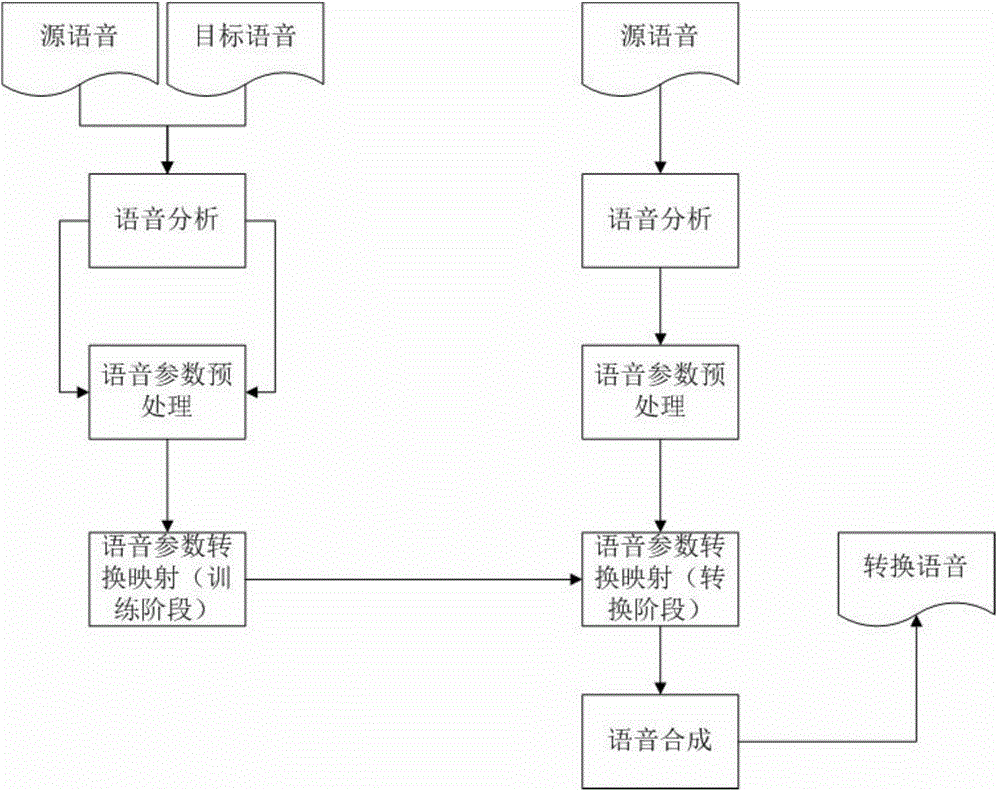

Voice conversion system based on hidden Gaussian random field

ActiveCN104091592AStrong non-linear mapping abilityImprove performanceSpeech recognitionGaussian random fieldDecomposition

The invention discloses a voice conversion system based on a hidden Gaussian random field. The voice conversion system comprises a voice analysis module, a voice synthesis module, a voice parameter pre-processing module and a voice parameter conversion mapping module. The voice analysis module and the voice synthesis module are used for carrying out decomposition and reconstruction on original voice signals. The voice parameter pre-processing module is used for sorting and screening feature parameters of a speaker A and a speaker B to obtain feature parameter sets synchronous in time. The voice parameter conversion mapping module is used for capturing the mapping relation between the feature parameter set A and the feature parameter set B to obtain a mapping rule. The core technology of the system expands around the Gaussian random field theory, a novel hidden Gaussian random field model is generated by changing the structure of the basic Gaussian random field, and the system can achieve an ideal effect under the environment of a lack of data.

Owner:CHANGZHOU INST OF TECH

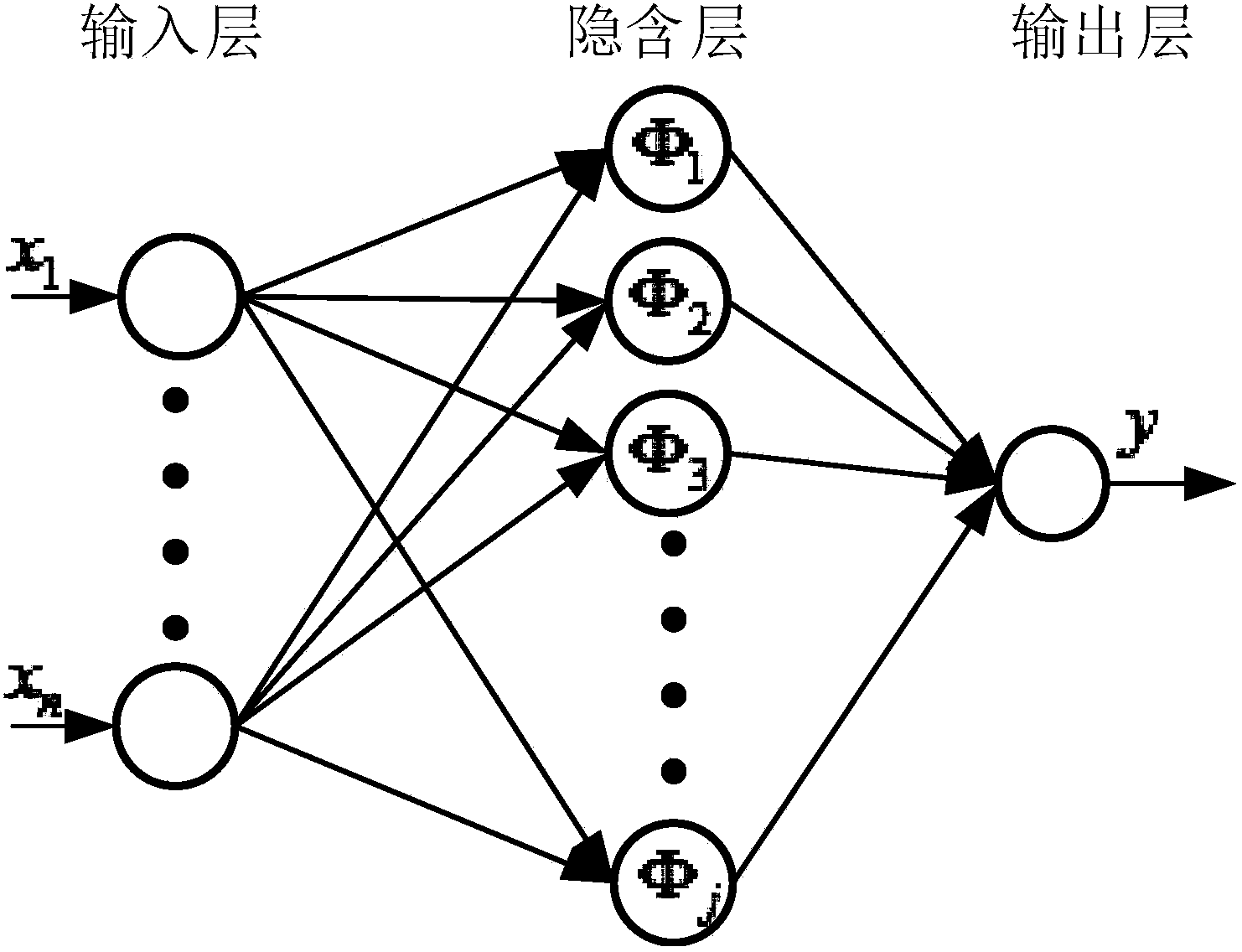

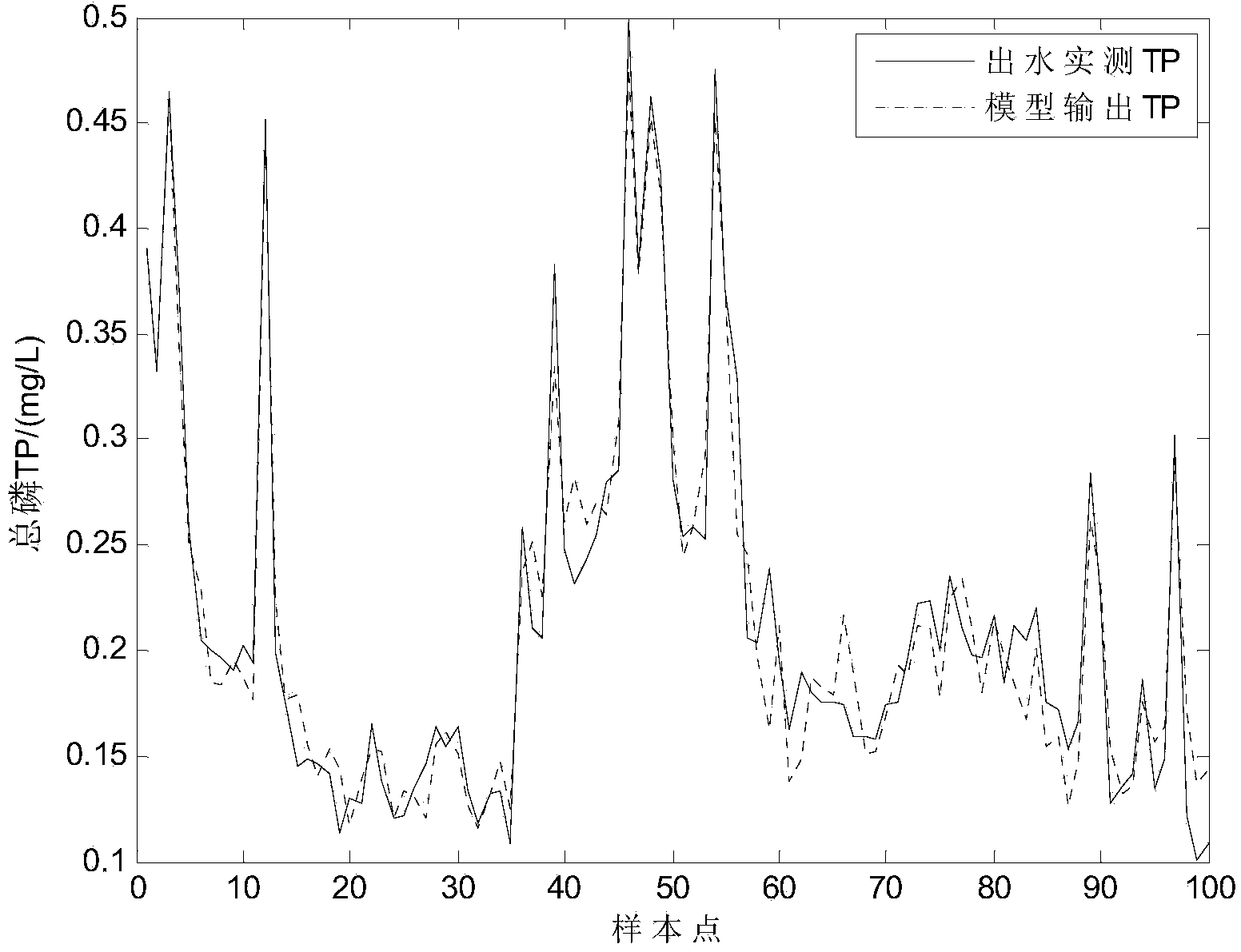

Method for soft measurement of effluent total phosphorus in sewage disposal process based on neural network

ActiveCN104182794AImplement soft sensingStrong non-linear mapping abilityTesting waterNeural learning methodsSewage treatmentSewage disposal plants

The invention provides a method for soft measurement of the effluent total phosphorus (TP) in the sewage disposal process based on the neural network, and belongs to the field of sewage disposal field. The mechanism is complex in the sewage disposal process, and to enable a sewage disposal system to be in a good running working condition and to obtain the higher effluent quality, the procedure parameters and the water quality parameters in the sewage disposal system need to be detected. The invention provides a soft measurement model established based on the self-organization radial-based neural network to solve the problem that the effluent total phosphorus of a current sewage disposal plant cannot be obtained in real time. The initial structure and the initial parameters of the neural network are determined according to the self-organization method, the structure of the neural network is simplified, and real-time soft measurement is carried out on the effluent TP. According to the soft measurement result, the related control link in the sewage disposal process and materials in the biochemical reaction are adjusted, the quality of the effluent obtained after sewage disposal is improved, and a theoretical support and a technological guarantee are provided for safe and stable running in the sewage disposal process.

Owner:BEIJING UNIV OF TECH

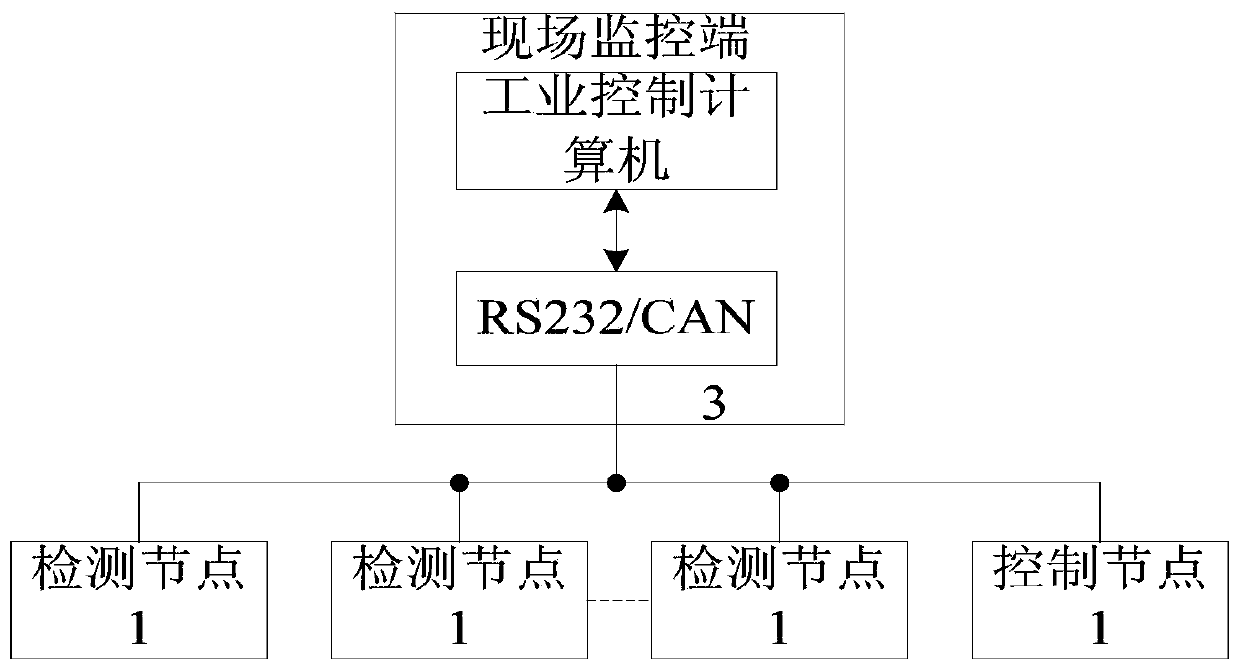

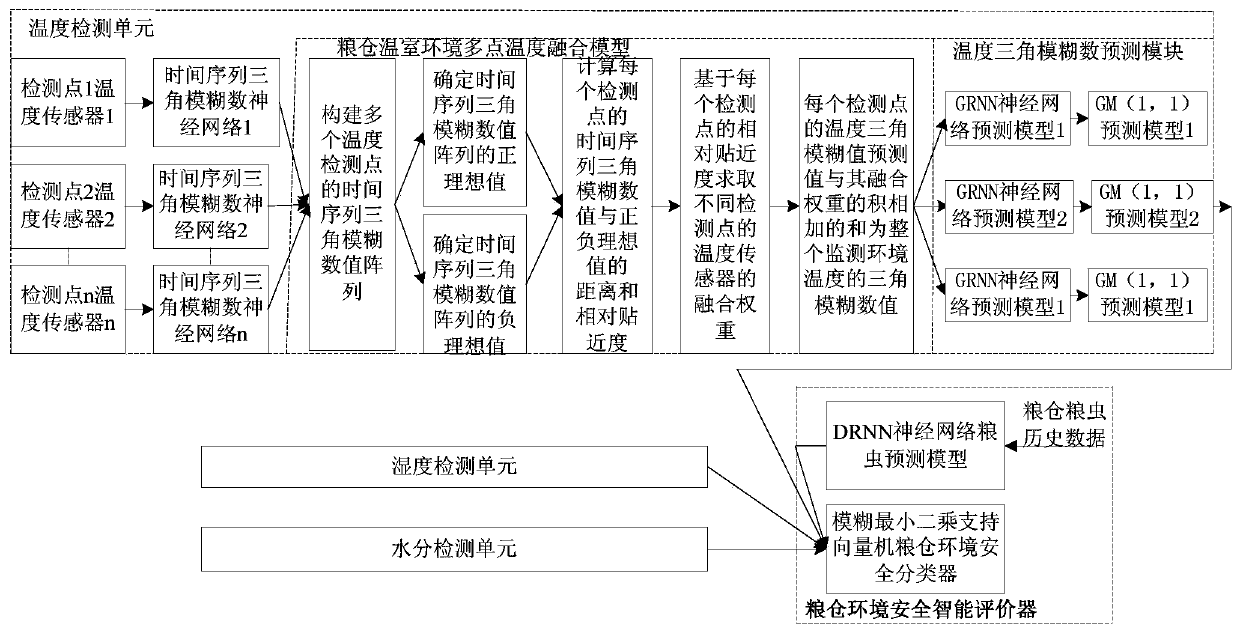

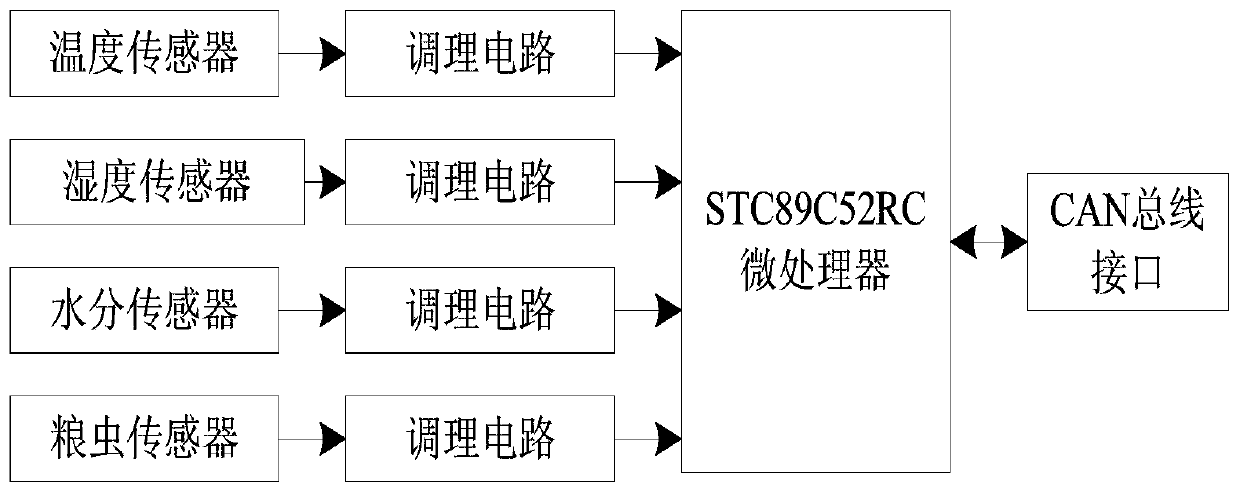

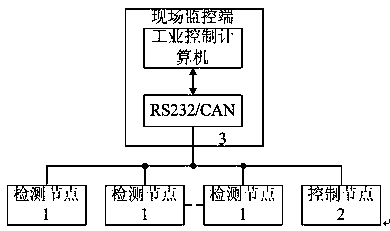

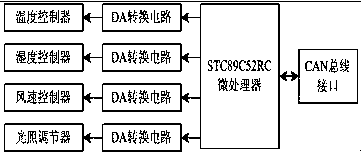

Intelligent granary environment safety monitoring system based on field bus

ActiveCN110580021AOvercome the inaccuracy and low reliability of the granary environmental monitoring systemImprove accuracy and robustnessTotal factory controlProgramme total factory controlEngineeringSafety monitoring

The invention discloses an intelligent granary environment safety monitoring system based on a field bus. The system is composed of a granary environment parameter collection platform based on a CAN field bus, and a granary environment safety evaluation subsystem. The system realizes the intelligent detection of granary environment parameters and the intelligent evaluation of granary environment safety. Many problems still existing in the granary environment caused by the unreasonably designed and poor traditional granary environment multi-parameter detection equipment, the incomplete detection system and the like are solved. Based on the nonlinearity and large lag of granary environment parameter changes and the large area and complex structure of the granary environment, the defects of inaccuracy, low reliability and the like of a granary environment monitoring system are overcome, accurate detection and reliable classification of granary environment parameters are realized, and therefore, the accuracy and robustness of granary environment parameter detection are greatly improved.

Owner:杨铿

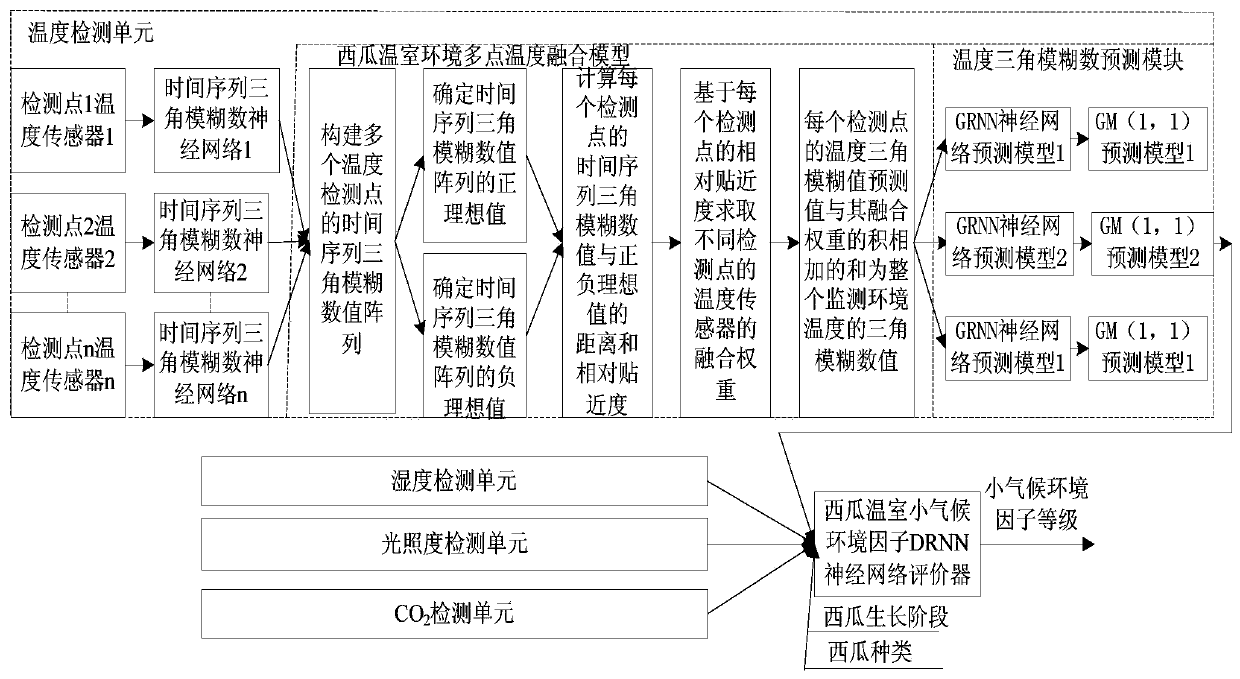

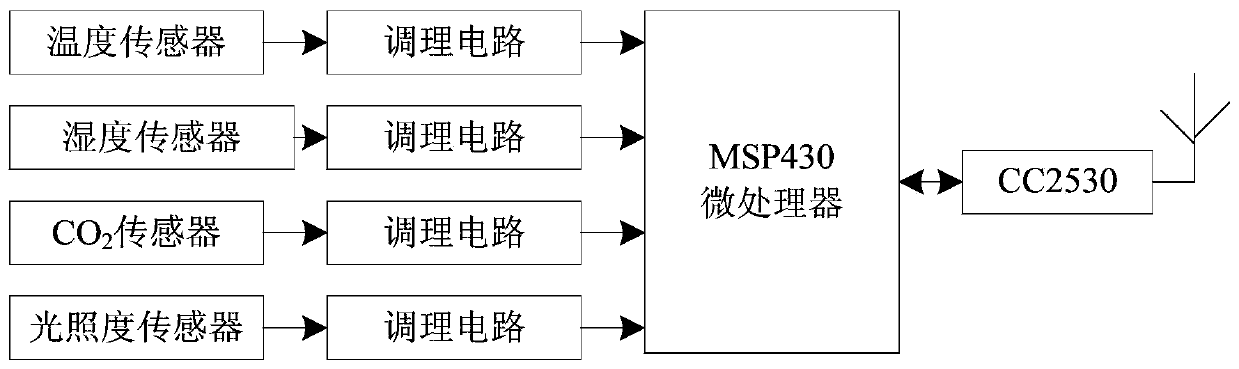

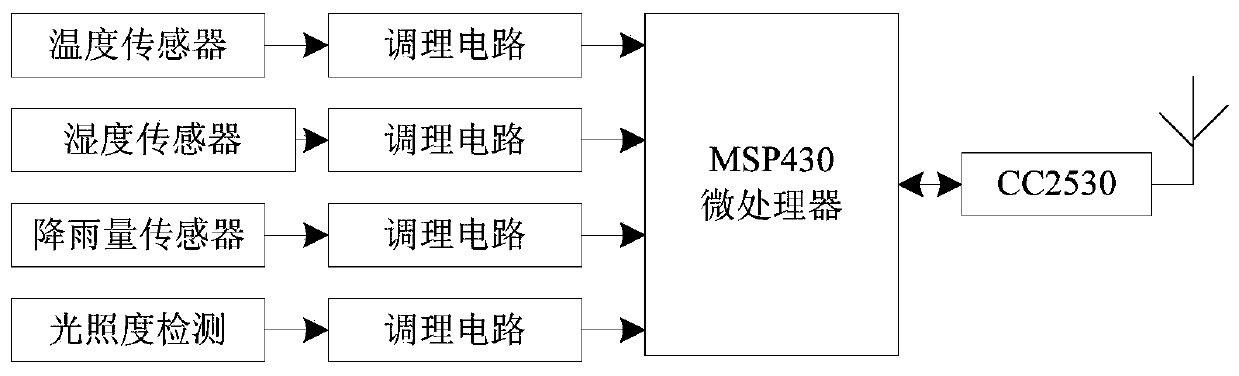

Greenhouse environment multi-parameter intelligent monitoring system based on Internet of Things

ActiveCN110647979AImprove objectivityIncrease credibilityMeasurement devicesForecastingEnvironmental resource managementGreenhouse

The invention discloses a greenhouse environment multi-parameter intelligent monitoring system based on the Internet of Things. The system is composed of a watermelon greenhouse environment parameteracquisition platform based on a ZigBee network and a watermelon greenhouse environment microclimate factor evaluation subsystem. The system realizes intelligent detection of watermelon greenhouse environment temperature and evaluation of microclimate environment factors. The problems that an existing watermelon greenhouse environment monitoring system does not accurately detect watermelon greenhouse environment parameters and evaluate environment factors according to the characteristics of nonlinearity, large lag, complex greenhouse environment parameter changes and the like of greenhouse environment parameter changes, and therefore the accuracy of predicting and evaluating the watermelon greenhouse parameters is improved are effectively solved.

Owner:威海晶合数字矿山技术有限公司

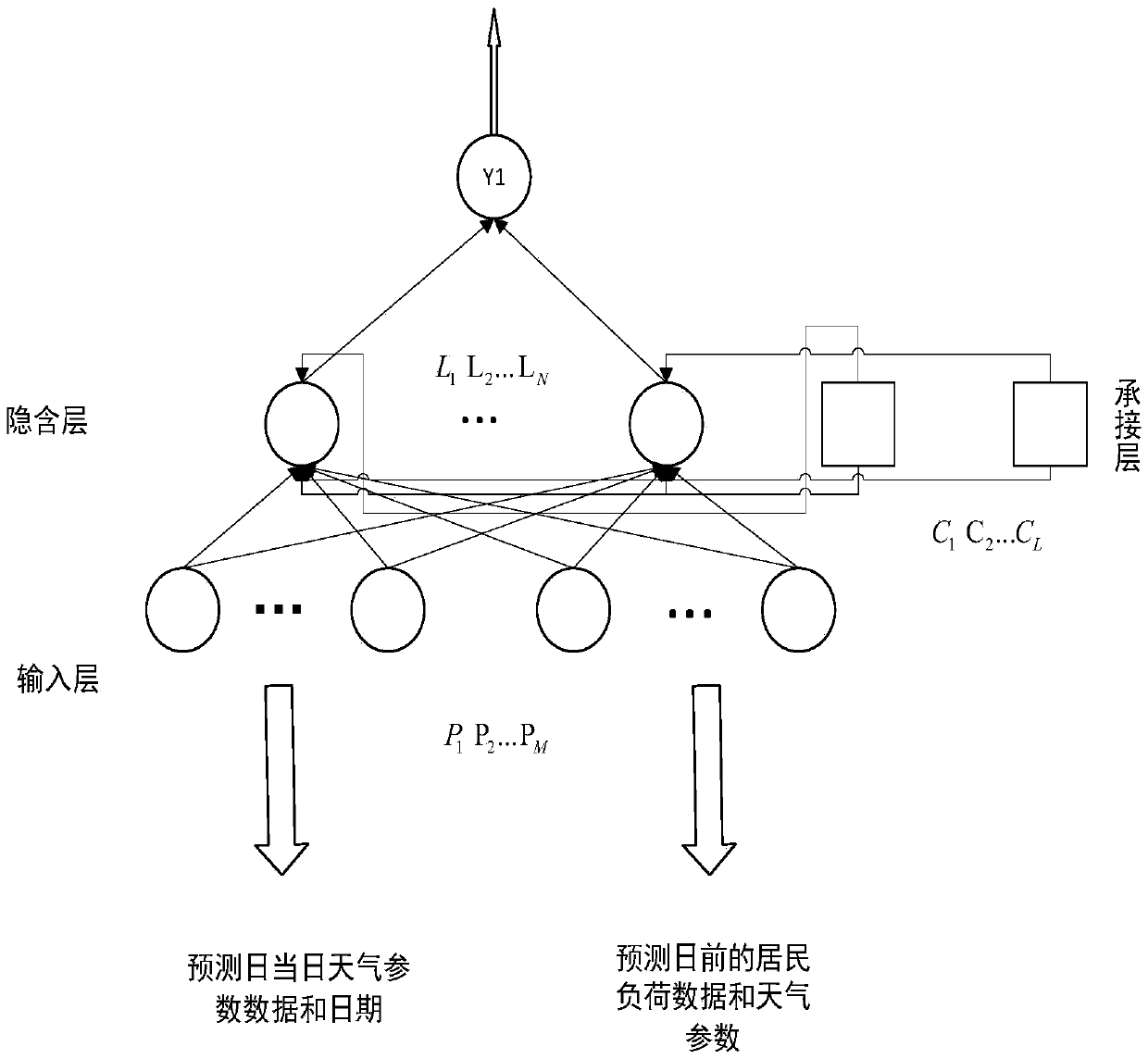

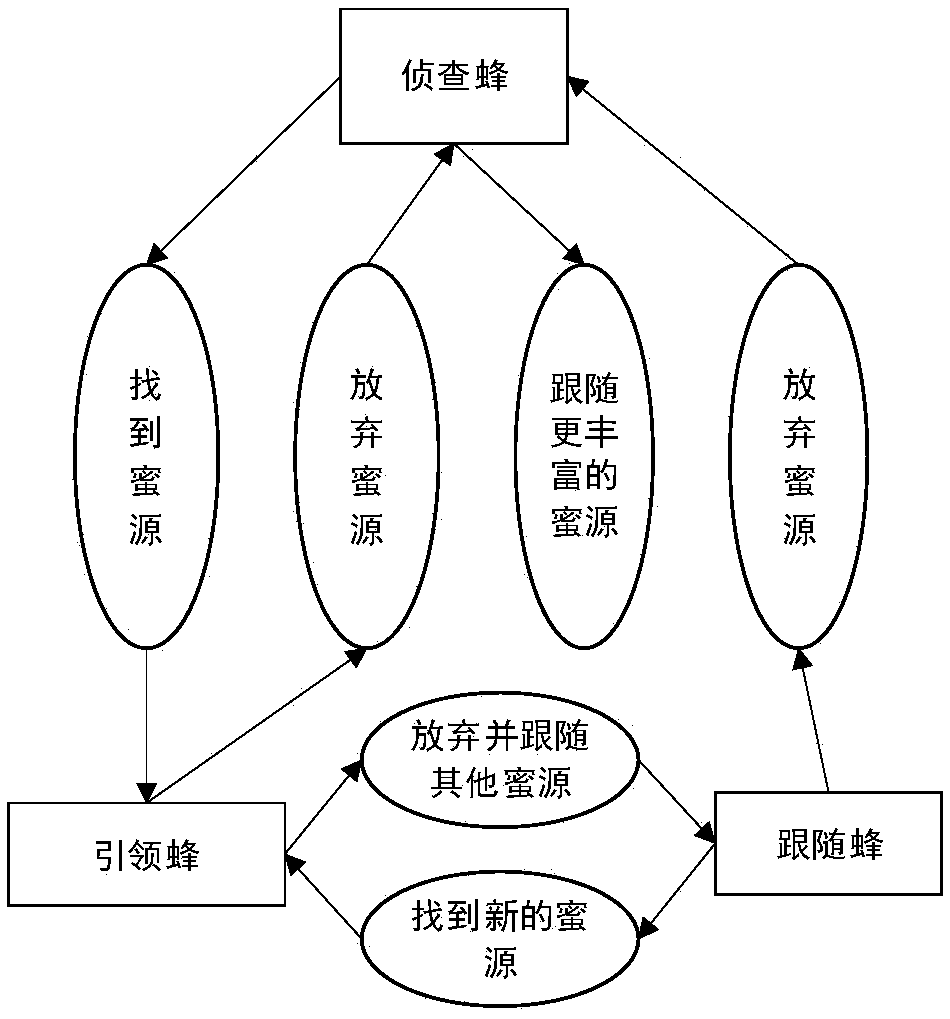

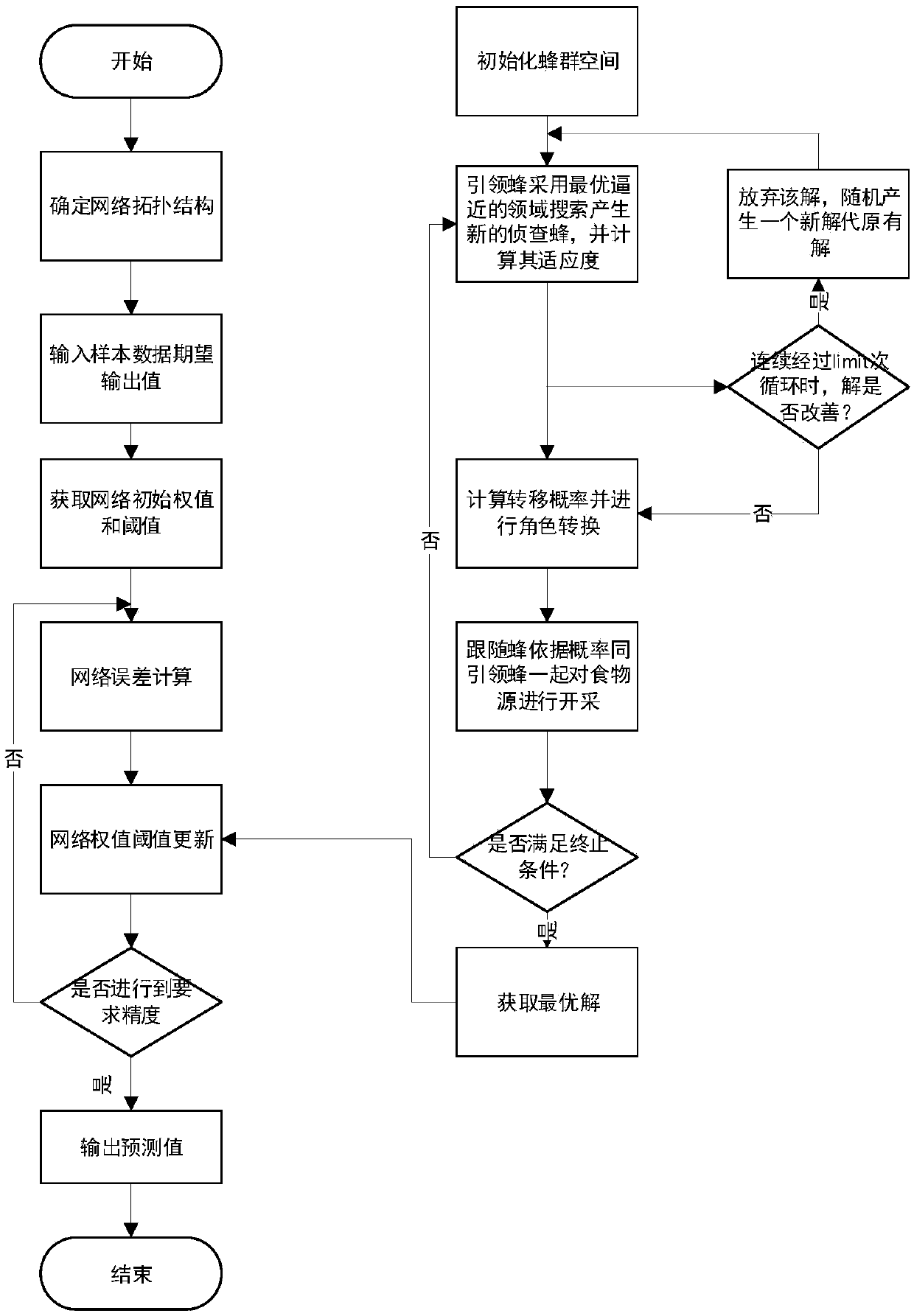

Short-term load predicting method for Elman neural network based on improved ABC algorithm

InactiveCN108734321AFast convergenceImprove stabilityReservationsNeural architecturesOptimal weightElectric power system

The invention discloses a short-term load predicting method for an Elman neural network based on an improved ABC algorithm. The short-term load predicting method comprises the following steps: takinga series of improving measures specific to defects such as low converging speed of an artificial bee colony (ABC) algorithm and poor developing performance of a searching equation after forward transmission of an input signal of the conventional Elman neural network, backward transmission of an error signal and a delay operator of a carrying layer are fully analyzed, wherein the improving measuresinclude re-designing a searching equation, adjusting the honey searching frequency and changing the selection mechanism of an optimal solution and the like; applying an optimal weight generated by the improved ABC algorithm and a threshold value to the Elman neural network to realize short-term load prediction on a power system, and increasing the load prediction speed; and lastly, implementing aload prediction function in MATLAB, and optimizing the weight and the threshold value by adopting the improved ABC algorithm according to an experiment result, so that the maximum prediction absoluteerror is lowered remarkably.

Owner:JIANGSU UNIV

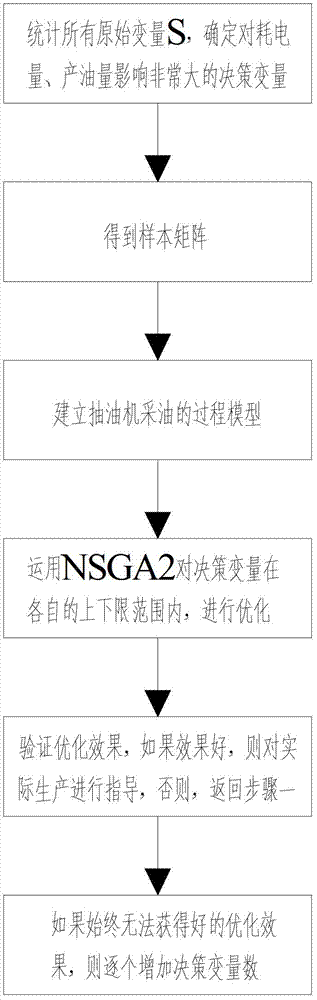

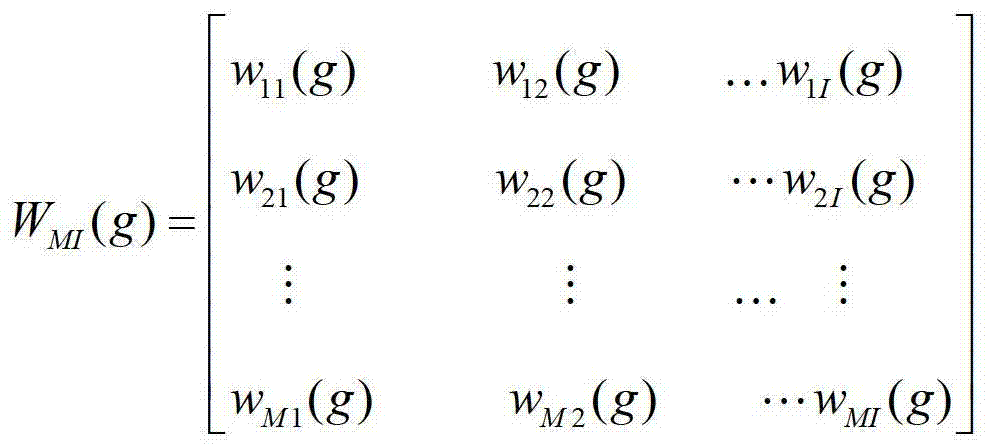

Optimization method of achieving oil field pumping unit oil-extraction energy conservation and production increasing with back propagation (BP) neural network and non-dominated sorting genetic algorithm (NSGA) 2

ActiveCN103198354AStrong non-linear mapping abilitySolve modeling problemsBiological neural network modelsProcess engineeringOil production

An optimization method of achieving oil field pumping unit oil-extraction energy conservation and production increasing with a back propagation (BP) neural network and a non-dominated sorting genetic algorithm (NSGA) 2 is characterized by comprising the steps of (1) determining a decision variable X; (2) collecting power consumption and oil production Y, and obtaining a sample matrix; (3) building a pumping unit oil extraction process model with the decision variable X as input and the power consumption and oil production Y as output; (4) optimizing the decision variable with the NSGA2 multiobjective evolutionary algorithm; (5) and substituting the optimized decision variable X optimization value in a back propagation neutral network (BPNN) model to guide practical production. The optimization method has the advantages that the best ideal point of production increasing and energy conservation can be searched out, the optimal values of process parameters can be determined, and practical production guidance is carried out according to the optimized process parameter optimal values.

Owner:重庆华燊科技集团有限公司

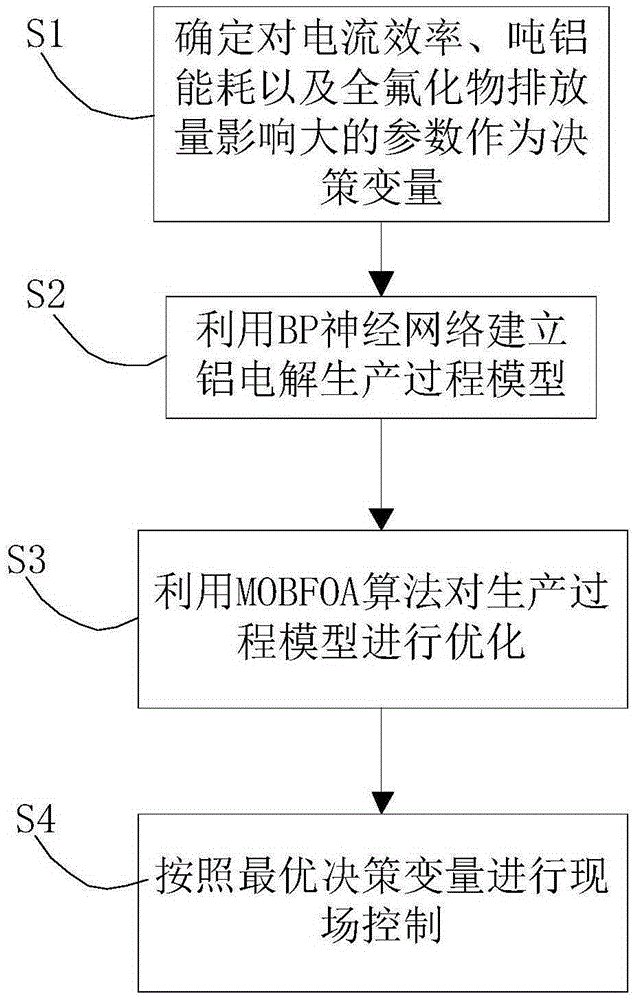

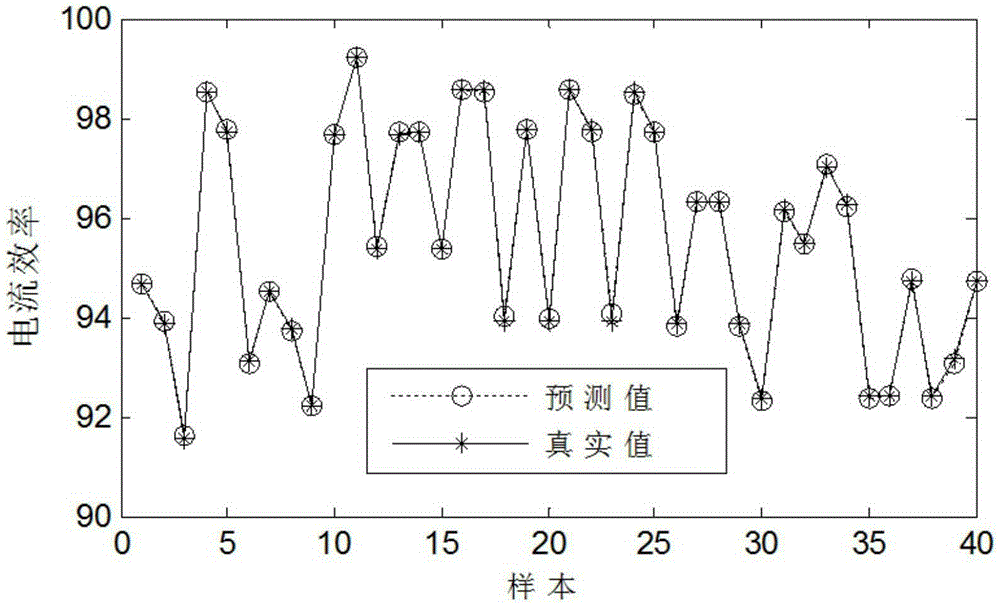

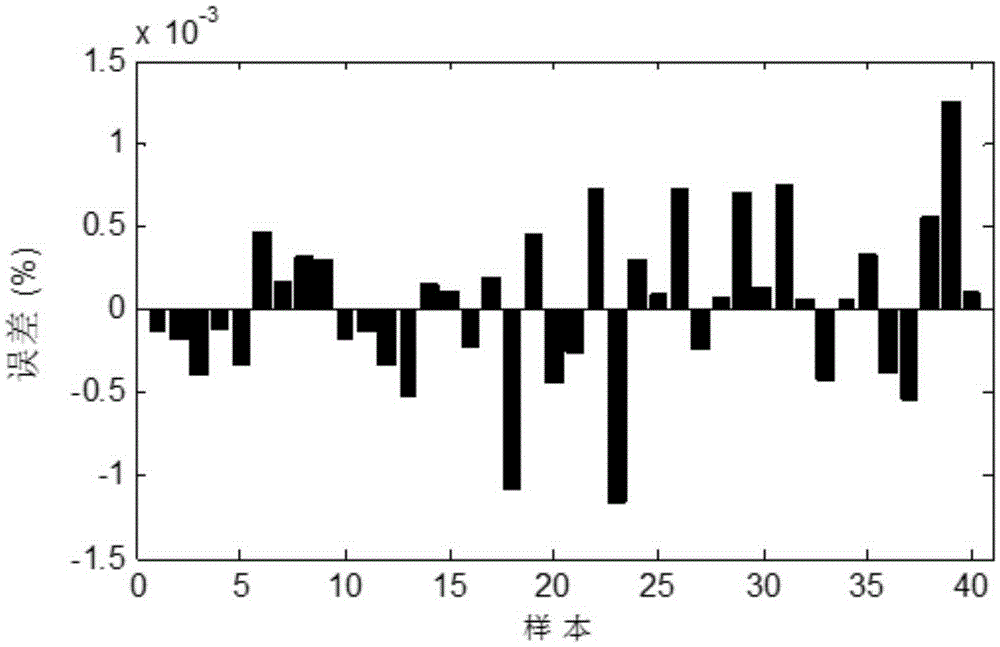

Aluminum electrolytic process parameter optimization method based on BP neural network and MOBFOA algorithm

ActiveCN105321000AStrong non-linear mapping abilityMove quicklyForecastingNeural learning methodsOptimal decisionLocal optimum

The present invention discloses an aluminum electrolytic process parameter optimization method based on a BP neural network and an MOBFOA algorithm, comprising the following steps of: 1, carrying out statistics on a parameter with large influence on current efficiency, ton aluminum energy consumption and perfluorinated compound emission and using the parameter as a decision variable X; 2, by using the BP neural network, establishing an aluminum electrolytic production process model; 3,, by using the MOBFOA algorithm, performing optimization on the decision variable in a value range of the decision variable; and 4, according to the optimal decision variable, performing field control. The aluminum electrolytic process parameter optimization method has advantages that the aluminum electrolytic production process model is established by using the BP neural-network with a strong non-linear mapping ability; and the optimization method directs flora to jump out of local optimization, the optimal production process parameter can be rapidly obtained, and the aims of high efficiency, consumption reduction and emission reduction are fulfilled.

Owner:CHONGQING UNIVERSITY OF SCIENCE AND TECHNOLOGY

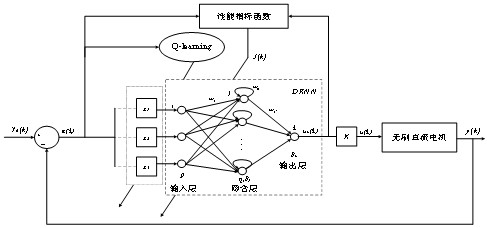

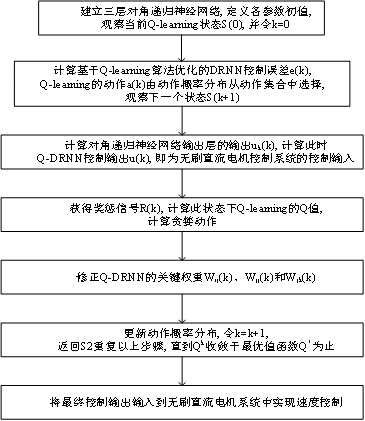

Diagonal recurrent neural network control strategy based on Q learning algorithm

ActiveCN111665718ASpeed up iterationImprove anti-interference abilityAdaptive controlMachine learningDiagonal recurrent neural network

The invention designs a diagonal recurrent neural network (DRNN) control strategy (Q-DRNN) based on a Q learning algorithm. The Q-DRNN organically combines the strong search capability of Q learning with the advantages of the built-in recursive ring structure, the dynamic mapping capability, the adaptive time-varying characteristic and the like of the DRNN, and is used for improving the working stability of a brushless direct current motor (BLDCM). In the Q-DRNN, the DRNN iterates an output variable through a unique recursive ring in a hidden layer, and optimizes the key weight of the output variable so as to accelerate the iteration speed; and meanwhile, the improved Q learning is introduced to correct the weight term factor of the DRNN, so that the DRNN has self-learning and online correction capabilities, the anti-interference capability and robustness of the system are enhanced, and the brushless direct current motor achieves a better control effect.

Owner:CHANGCHUN UNIV OF TECH

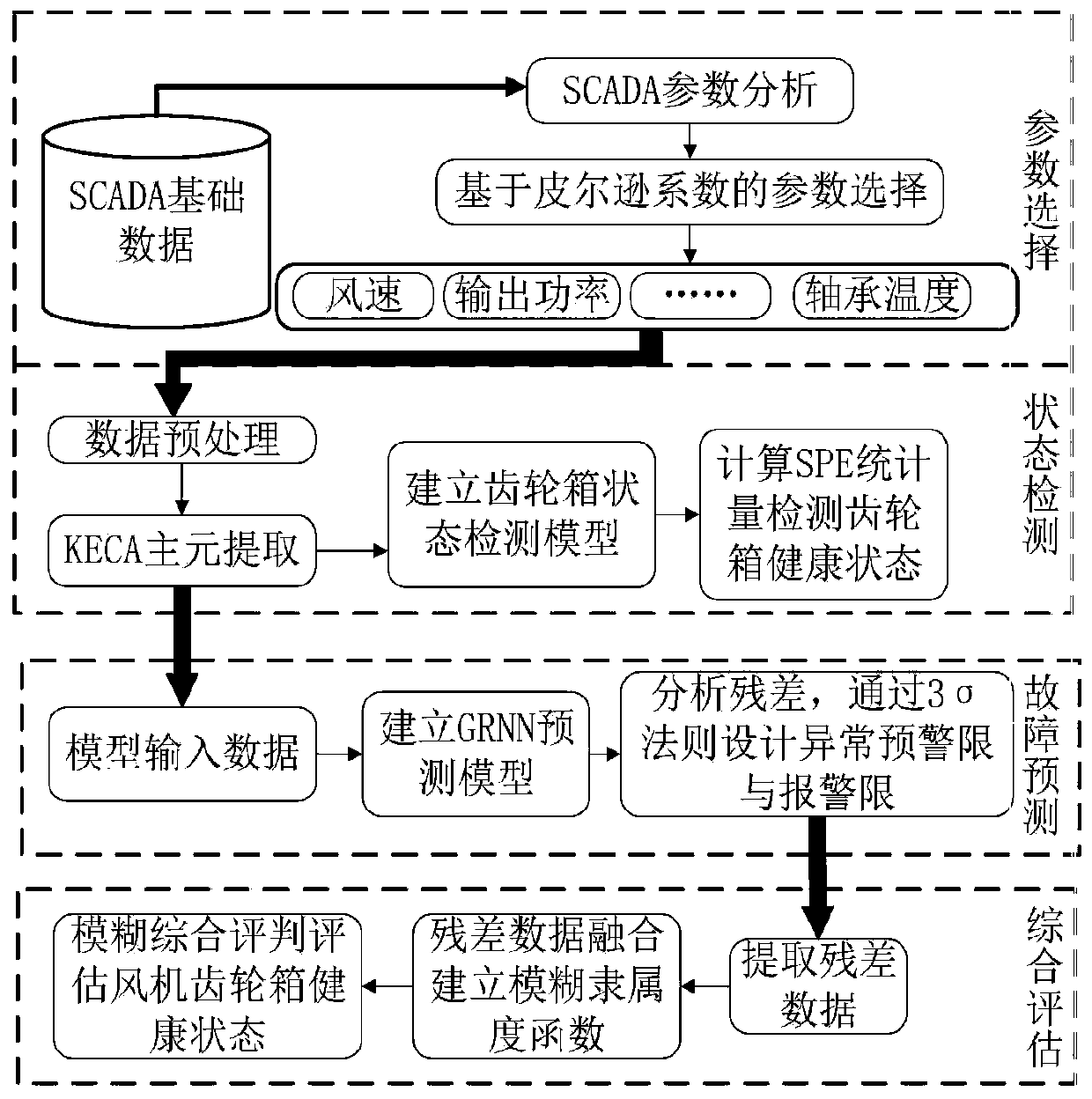

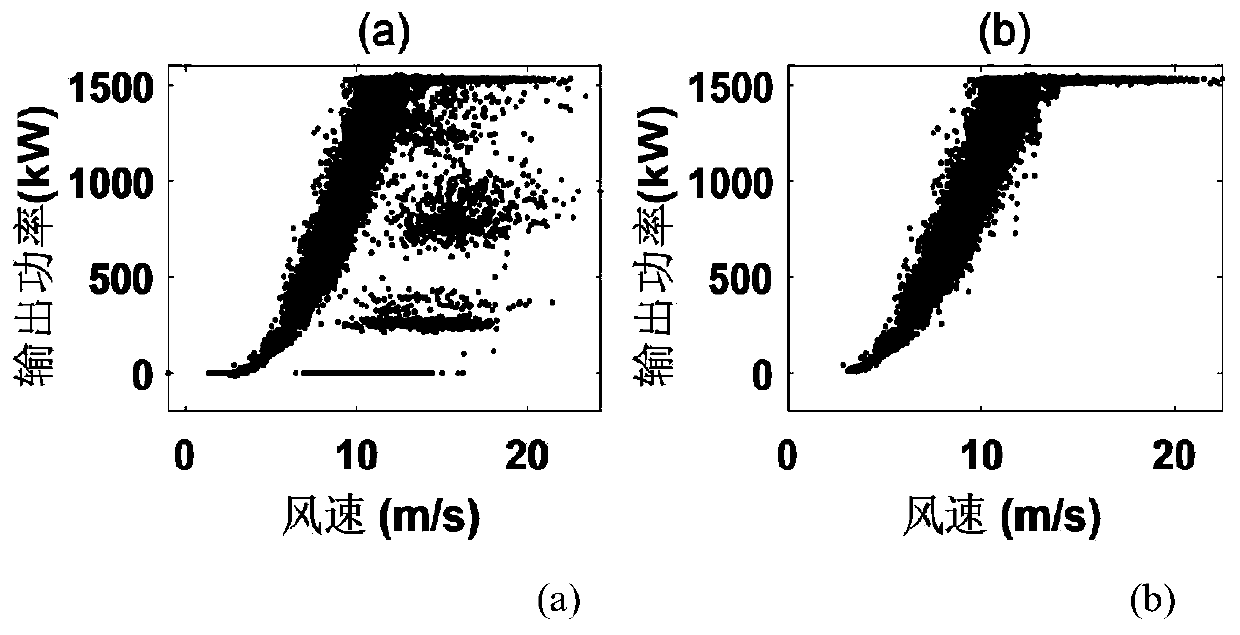

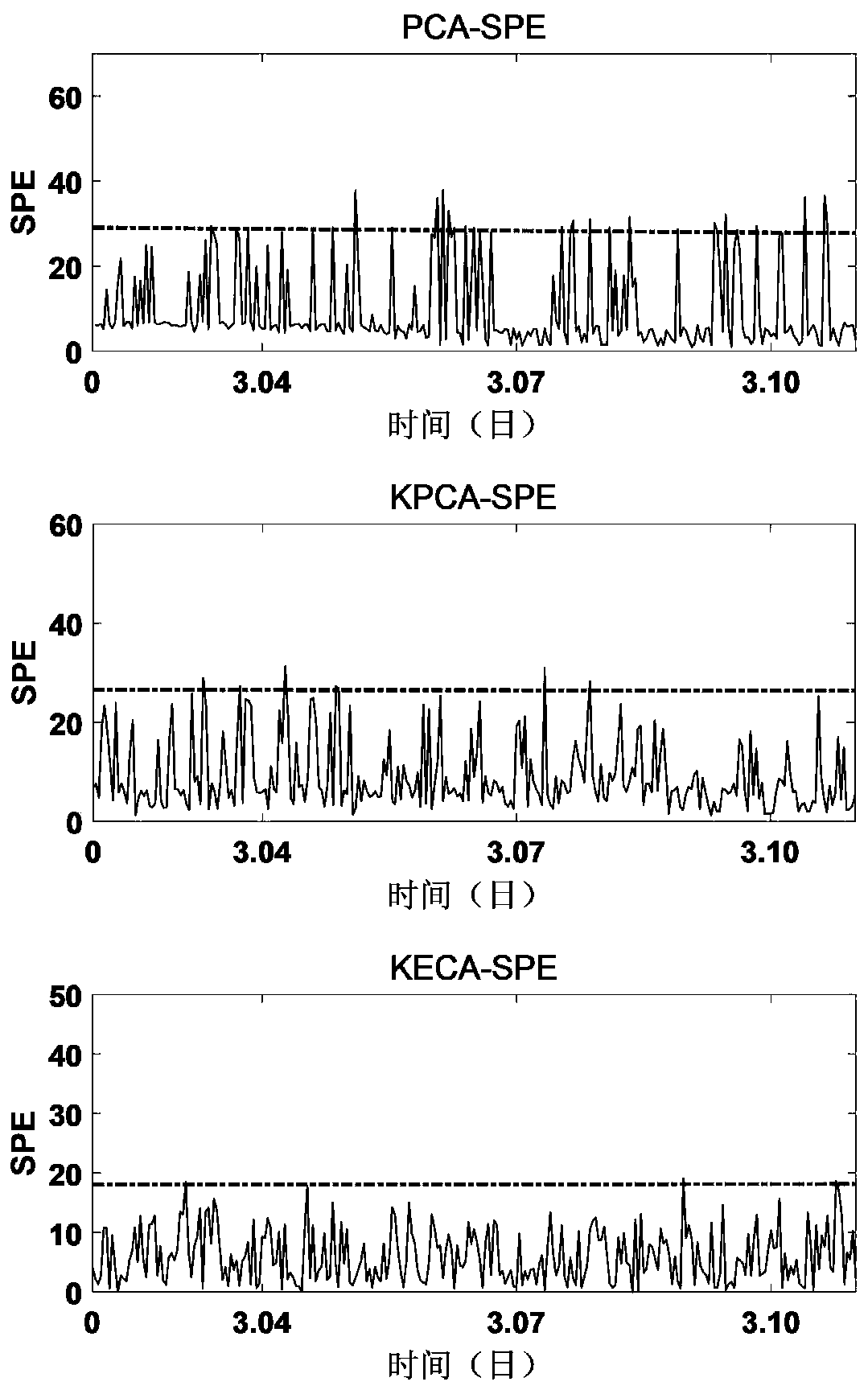

Fan gearbox performance detection and health evaluation method based on temperature parameters

ActiveCN111537219AResults are accurate and intuitiveFast convergenceMachine gearing/transmission testingControl engineeringTurbine

The invention discloses a fan gearbox performance detection and health evaluation method based on temperature parameters. According to the method, fan state detection data are analyzed, the operationcharacteristics of a wind turbine generator unit are combined, state detection and fault prediction are carried out on the temperature of a gearbox and the temperature of a gearbox bearing by adoptinga model established by combining KECA and GRNN, an evaluation decision is performed on the running state of the fan gearbox through ideas of threshold discrimination and statistical process control according to predicted residual error, and a gearbox health state result is obtained by adopting comprehensive fuzzy discrimination. When the method is applied to an actual wind turbine generator unitcase with small sample data, the health state of the wind turbine generator unit can be accurately predicted and evaluated. The method is applied to an actual wind turbine generator unit with small sample data, and the health state of the wind turbine generator unit can be accurately predicted and evaluated.

Owner:INNER MONGOLIA UNIV OF TECH

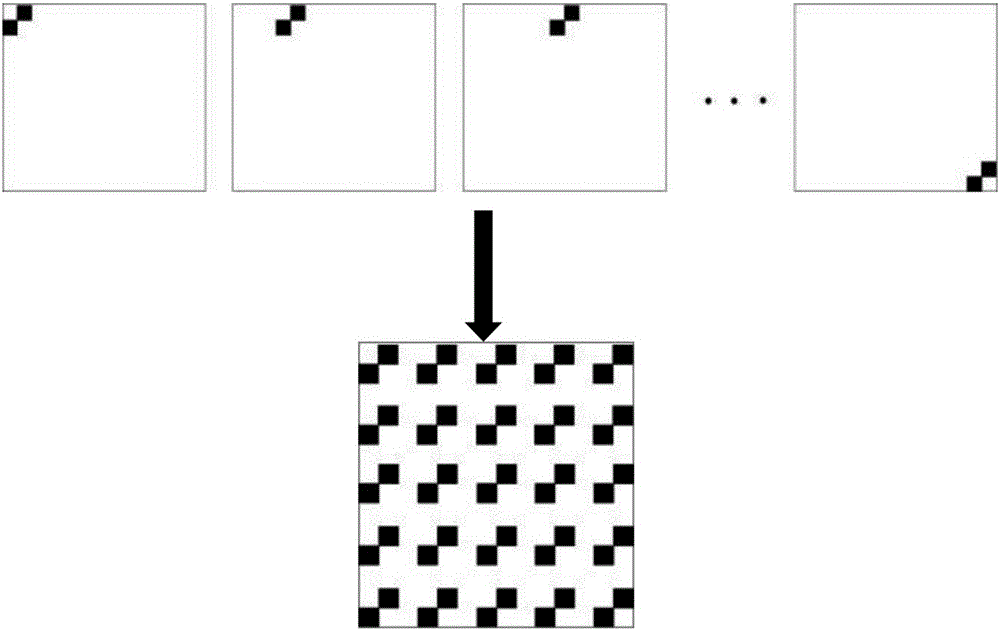

Stereo visual calibration method integrating neural network and virtual target

InactiveCN106127789AStrong non-linear mapping abilityEasy to processImage enhancementImage analysisHidden layerVirtual target

The invention discloses a stereo vision calibration method combining a neural network and a virtual target, comprising the following steps: S1, using a single corner point target to construct a stereo virtual target, acquiring a corner point image and recording the world three-dimensional coordinates of the corner point during the construction process ; S2, extract the pixel coordinates of the corner points in the image; S3, use the neural network to train the pixel coordinates of the corner points and the world three-dimensional coordinates; S4, input the test samples into the training neural network for three-dimensional reconstruction, and calculate the reconstruction error; S5, Change the number of hidden layer nodes of the neural network to minimize the error. On the one hand, the method of the present invention utilizes a single-corner checkerboard to construct a three-dimensional virtual target with a controllable range, which solves the problem of difficult production and processing of large targets; on the other hand, it uses a neural network to calibrate the camera without establishing complex nonlinear distortion model, the calibration accuracy is significantly higher than the linear calibration method. The invention is practical, simple and easy to operate and has high precision.

Owner:HUNAN UNIV OF SCI & TECH

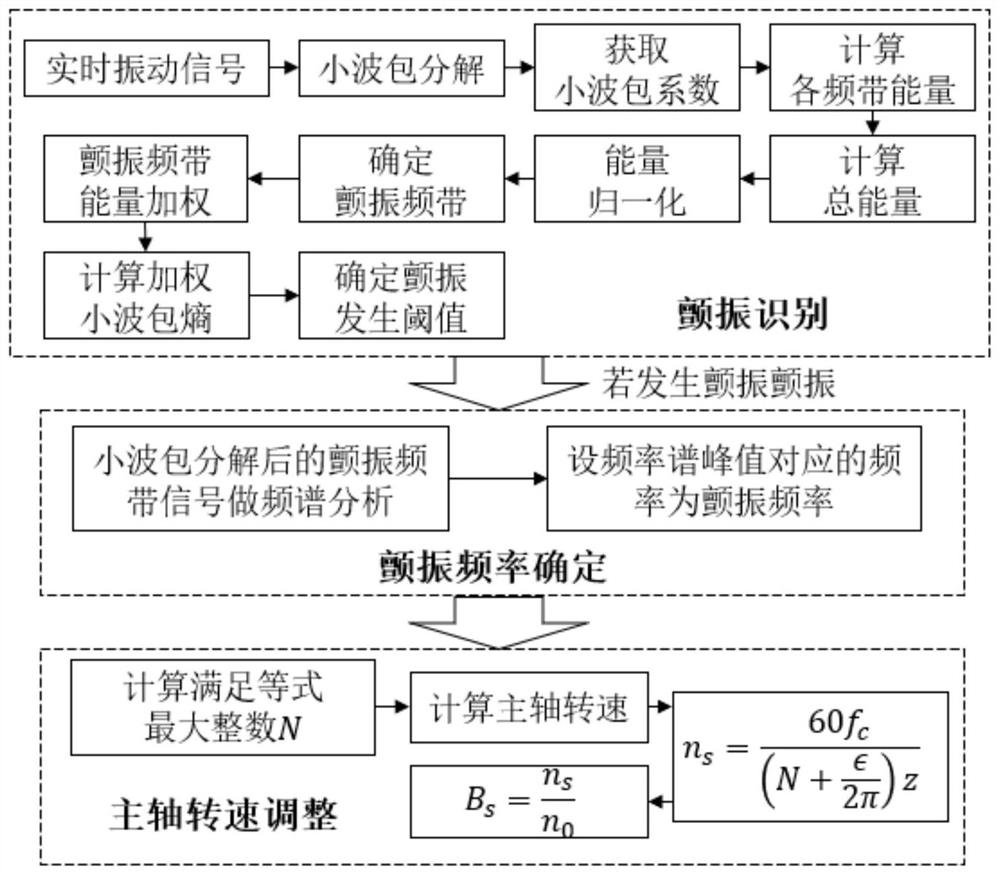

Machine tool self-adaptive control method considering flutter suppression

ActiveCN111694320AImprove processing efficiencySave production time and costProgramme controlComputer controlNumerical controlControl engineering

The invention discloses a machine tool self-adaptive control method considering flutter suppression. A spindle motor power signal and a spindle vibration signal in the numerical control machining process are monitored in real time, real-time self-adaptive regulation and control are conducted on the feeding speed and the spindle rotating speed based on the spindle power signal and the spindle vibration signal, and normal machining is not affected in the whole signal collecting process. According to the machine tool self-adaptive control method considering chatter suppression, the machining efficiency can be effectively improved, flutter generated in the machining process can be monitored and suppressed, the machining quality is improved to the maximum extent on the basis that the machiningefficiency is improved, the service life of a cutter and a machine tool can be prolonged, and the production cost is reduced.

Owner:DALIAN UNIV OF TECH

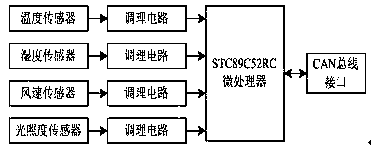

Intelligent tomato greenhouse temperature early-warning system based on minimum vector machine

ActiveCN110119169AImprove forecast accuracyStrong targetingTemperatue controlEarly warning systemControl system

The invention discloses an intelligent tomato greenhouse temperature early-warning system based on a minimum vector machine. The early-warning system is characterized by being composed of a tomato greenhouse environmental parameter acquisition and intelligent prediction platform based on a CAN field bus and an intelligent tomato greenhouse temperature early-warning system. By means of the intelligent tomato greenhouse temperature early-warning system based on the minimum vector machine in the invention, many problems still in the environment in a closed tomato greenhouse due to the reasons ofunreasonable design, backward equipment, incomplete control system and the like in the traditional tomato greenhouse environment can be effectively solved; and furthermore, the control problem that the tomato greenhouse environment temperature is greatly influenced due to the fact that the existing tomato greenhouse environment monitoring system does not monitor and predict the temperature in thetomato greenhouse environment according to the characteristics of nonlinearity and large lag of tomato greenhouse environmental temperature change, large tomato greenhouse area, complex temperature change and the like can be effectively solved.

Owner:淮安润联信息科技有限公司

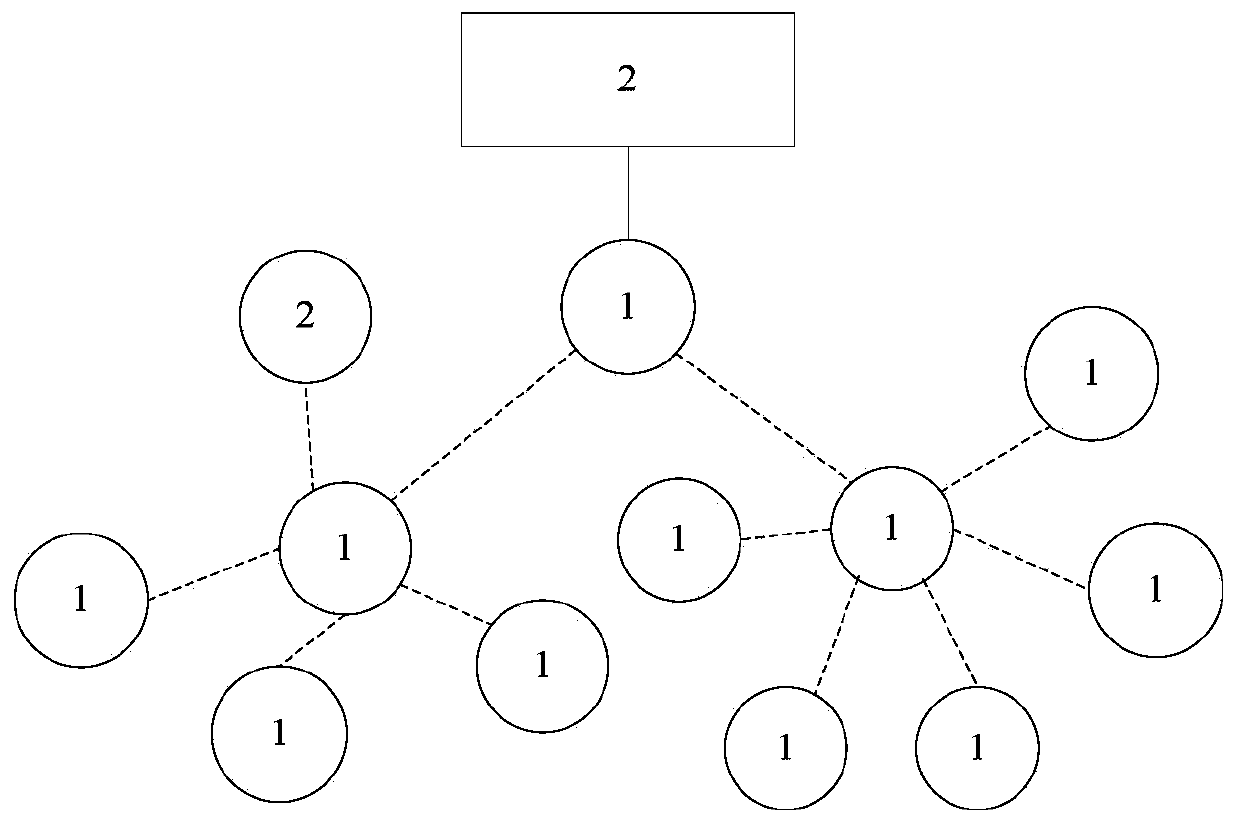

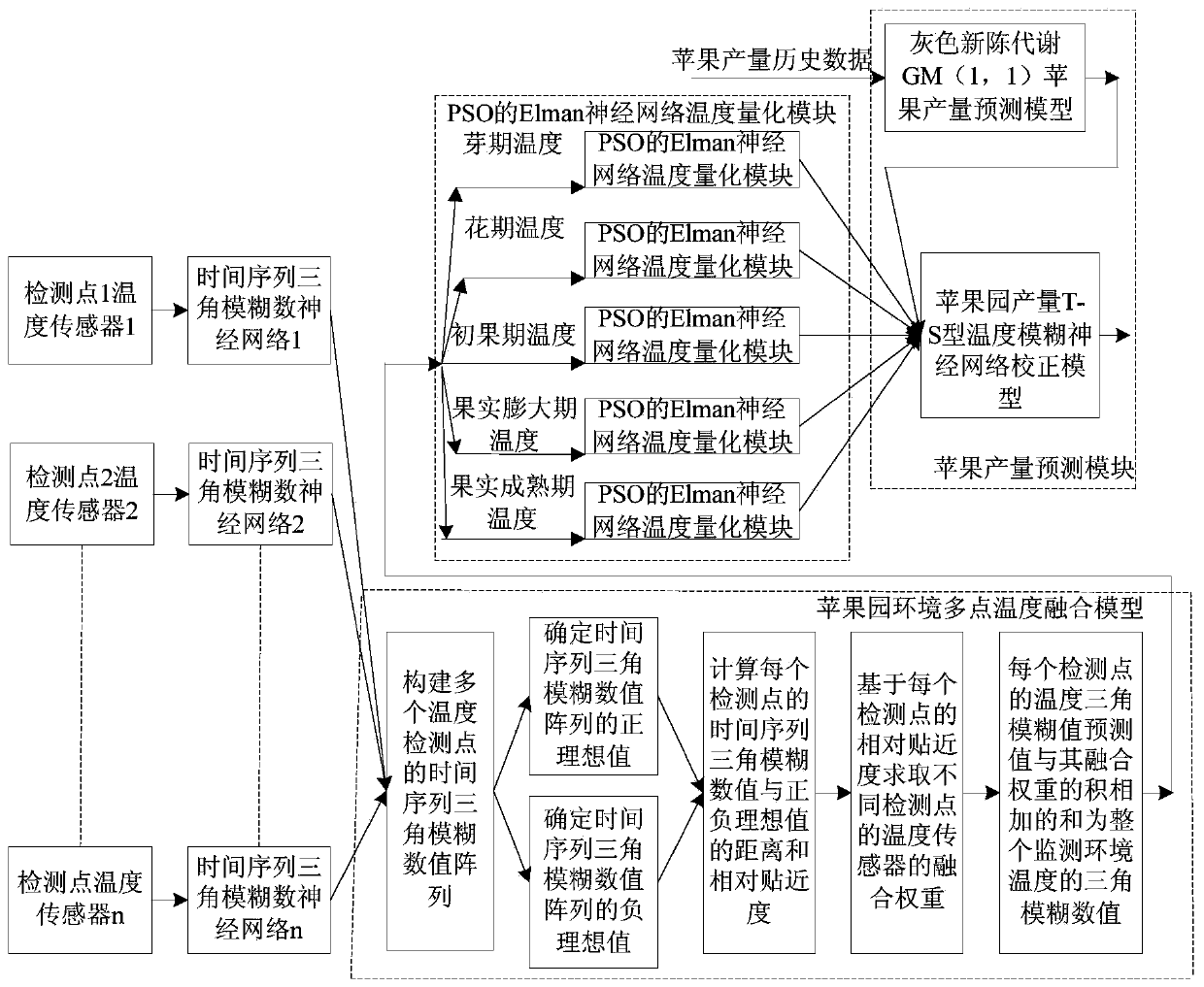

Intelligent orchard yield prediction system based on Internet of Things

ActiveCN110766132AImprove objectivityIncrease credibilityMeasurement devicesForecastingAgricultural engineeringPrediction system

The invention discloses an intelligent orchard yield prediction system based on Internet of Things. The intelligent orchard yield prediction system consists of an apple orchard environment parameter collection platform and an apple orchard environment yield prediction subsystem, and achieves the detection of apple orchard environment microclimate parameters and the prediction of the yield. The apple orchard environment monitoring system effectively solves the problems that an existing apple orchard environment monitoring system does not accurately detect the apple orchard environment temperature and predict the yield according to the characteristics of nonlinearity, large lag, complex change and the like of the apple orchard environment temperature change, so that the accuracy and robustness of predicting the apple orchard environment temperature and yield are improved.

Owner:四川超易宏科技有限公司

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com