Credit evaluation method and system for small and micro enterprises, storage medium and electronic equipment

A credit evaluation and enterprise technology, applied in the field of data analysis, can solve the problems of enterprise credit evaluation model generation algorithm, lack of information, inequity, etc., to shorten the time of credit evaluation, objective and comprehensive enterprise evaluation, and improve efficiency.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

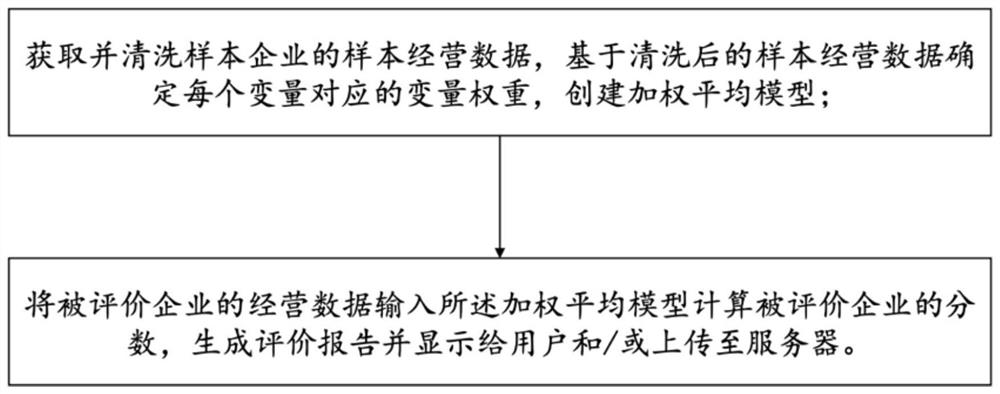

[0048] see figure 1 , a credit evaluation method for small and micro enterprises, comprising:

[0049] Obtain and clean the sample business data of the sample enterprises, determine the variable weight corresponding to each variable based on the cleaned sample business data, and create a weighted average model;

[0050] Input the business data of the evaluated enterprise into the weighted average model to calculate the score of the evaluated enterprise, generate an evaluation report and display it to the user and / or upload it to the server.

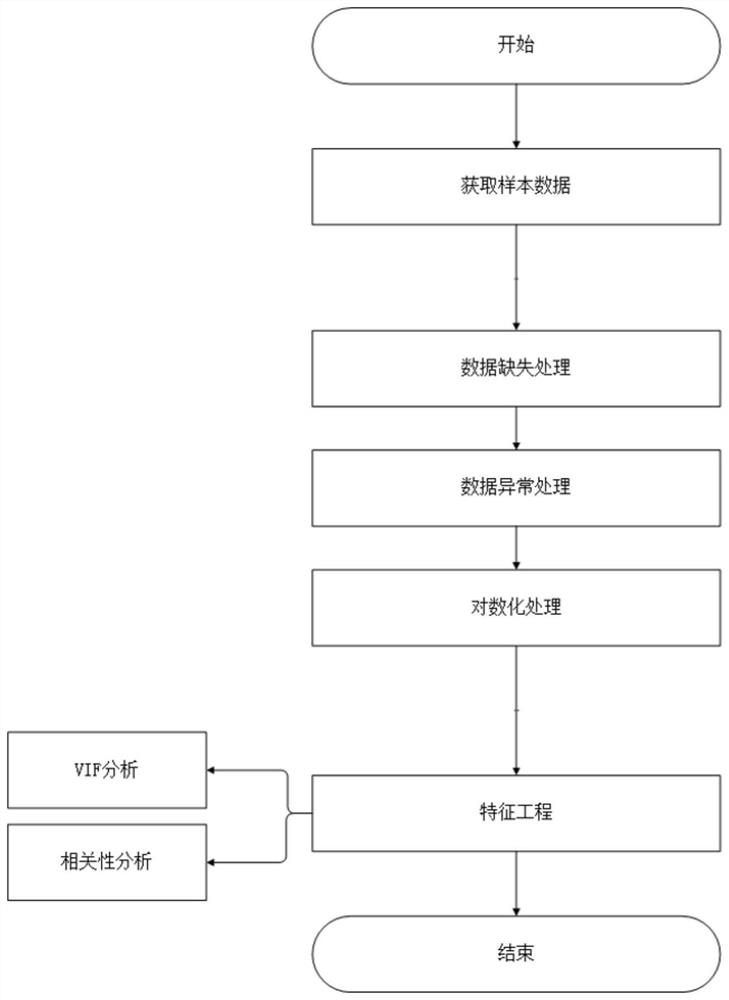

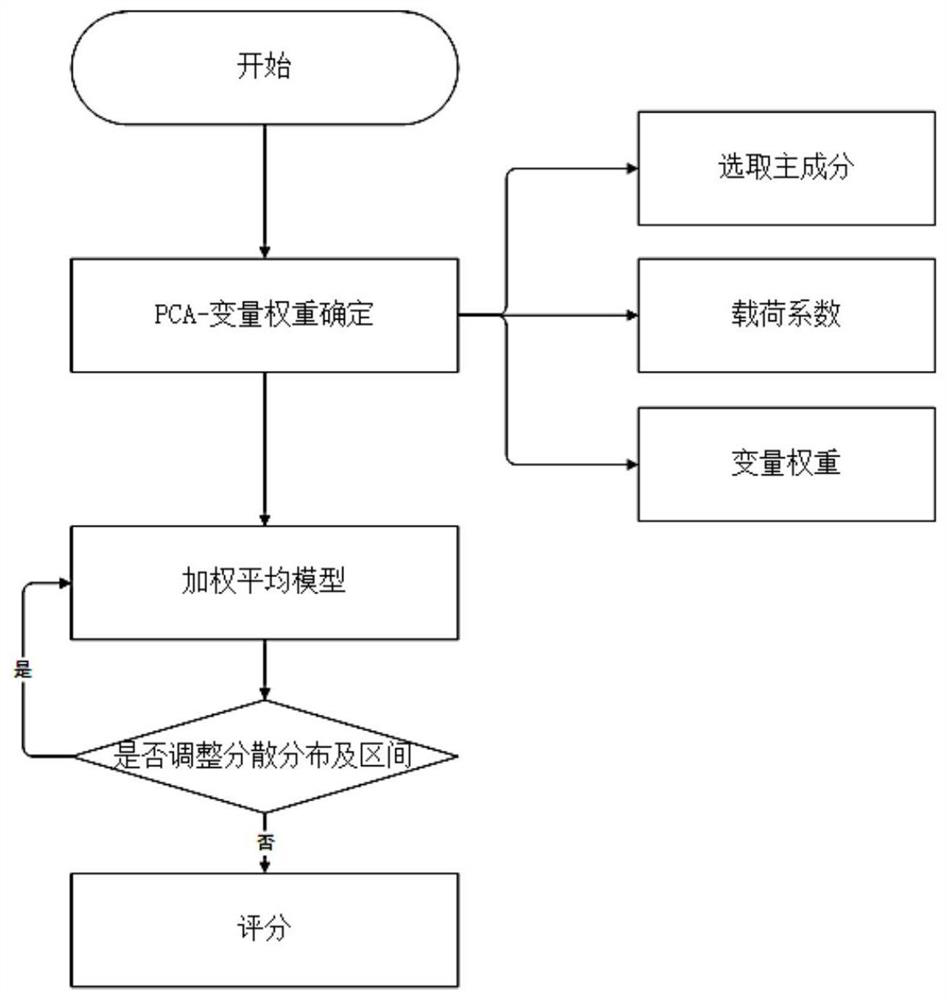

[0051] The credit evaluation method for small and micro enterprises provided by the present invention utilizes statistical principles, machine learning and algorithmic modeling to firstly analyze and process sample business data, use the principal component method to determine the weight of each variable, and then generate a weighted average model; then according to the large The principle of data correlation, based on the generated mode...

Embodiment 2

[0099] A credit evaluation system for small and micro enterprises, including a model generation module and an evaluation module, wherein the model generation module is used to obtain and clean sample business data of sample enterprises, and determine the variable weight corresponding to each variable based on the cleaned sample business data , creating a weighted average model; the evaluation module is used to input the business data of the evaluated enterprise into the weighted average model to calculate the score of the evaluated enterprise, generate an evaluation report and display it to the user and / or upload it to the server.

[0100] The credit evaluation system for small and micro enterprises provided by the present invention adopts the credit evaluation method for small and micro enterprises in the above-mentioned embodiment 1 to perform dynamic ratings on the evaluated enterprises, which can more objectively and comprehensively reflect the credit level of the evaluated ...

Embodiment 3

[0102] An embodiment of the present invention provides a computer-readable storage medium having computer-readable program instructions stored thereon, and the computer-readable program instructions are used to execute the credit evaluation method for small and micro enterprises in the first embodiment above.

[0103] The computer-readable storage medium provided by the embodiments of the present invention may be—but not limited to—electric, magnetic, optical, electromagnetic, infrared, or semiconductor systems, systems, or devices, or any combination thereof. More specific examples of computer-readable storage media may include, but are not limited to, electrical connections with one or more wires, portable computer diskettes, hard disks, random access memory (RAM), read-only memory (ROM), erasable Programmable read-only memory (EPROM or flash memory), optical fiber, portable compact disk read-only memory (CD-ROM), optical storage device, magnetic storage device, or any suitab...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com