CS-PNN-based customer credit risk assessment method and system

A customer and credit technology, applied in the risk control field of the Internet financial industry, can solve the problems of long learning process, easy to fall into local optimum, poor robustness, etc.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

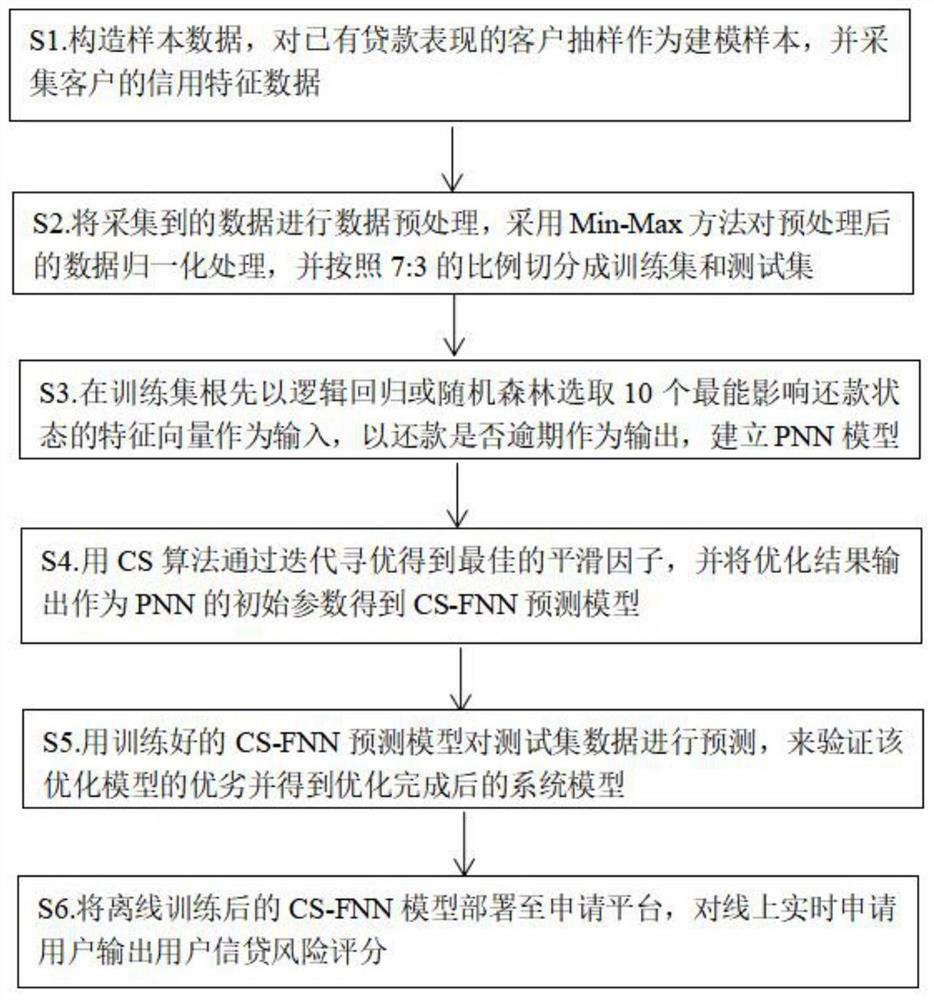

[0075] see figure 1 , the present invention provides a technical solution:

[0076] A method and system for assessing customer credit risk based on CS-PNN, comprising the following steps:

[0077] S1. Construct sample data, sample customers with existing loan performance as modeling samples, and collect customer credit characteristic data;

[0078] S2. Perform data preprocessing on the collected data, use the Min-Max method to normalize the preprocessed data, and divide it into a training set and a test set according to a ratio of 7:3;

[0079] S3. In the training set, first select 10 feature vectors that can most affect the repayment status by logistic regression or random forest as input, and use whether the repayment is overdue as output to establish a PNN prediction model;

[0080] S4. Use the CS algorithm to optimize the smoothing factor of PNN. The optimization algorithm aims at the accuracy of the model, obtains the best smoothing factor through iterative optimization...

Embodiment 2

[0143] The same parts of Embodiment 2 and Embodiment 1 will not be described in detail. The difference is: in S1, the customers with existing loan performance are sampled as modeling samples, and the credit characteristic data of customers are collected. The credit characteristic data includes personal basic information, Operational behavior data and third-party data, this setting is conducive to the collection of user data,

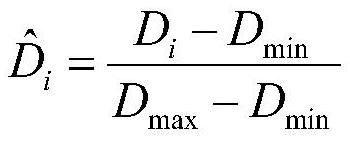

[0144] In S2, in the input of the neural network, due to the different units of each input, the order of magnitude differs greatly; if the direct input is used, it is easy to make the neuron training saturated, so before the input training, the data must be Normalize to make it at the same quantitative level, and use the Min-Max method to normalize the preprocessed data. The calculation formula is as follows:

[0145]

[0146] in, is the normalized data, D max is the maximum value of the training sample set, D min is the minimum value of the train...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com