Patents

Literature

54 results about "Patent portfolio" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A patent portfolio is a collection of patents owned by a single entity, such as an individual or corporation. The patents may be related or unrelated. Patent applications may also be regarded as included in a patent portfolio.

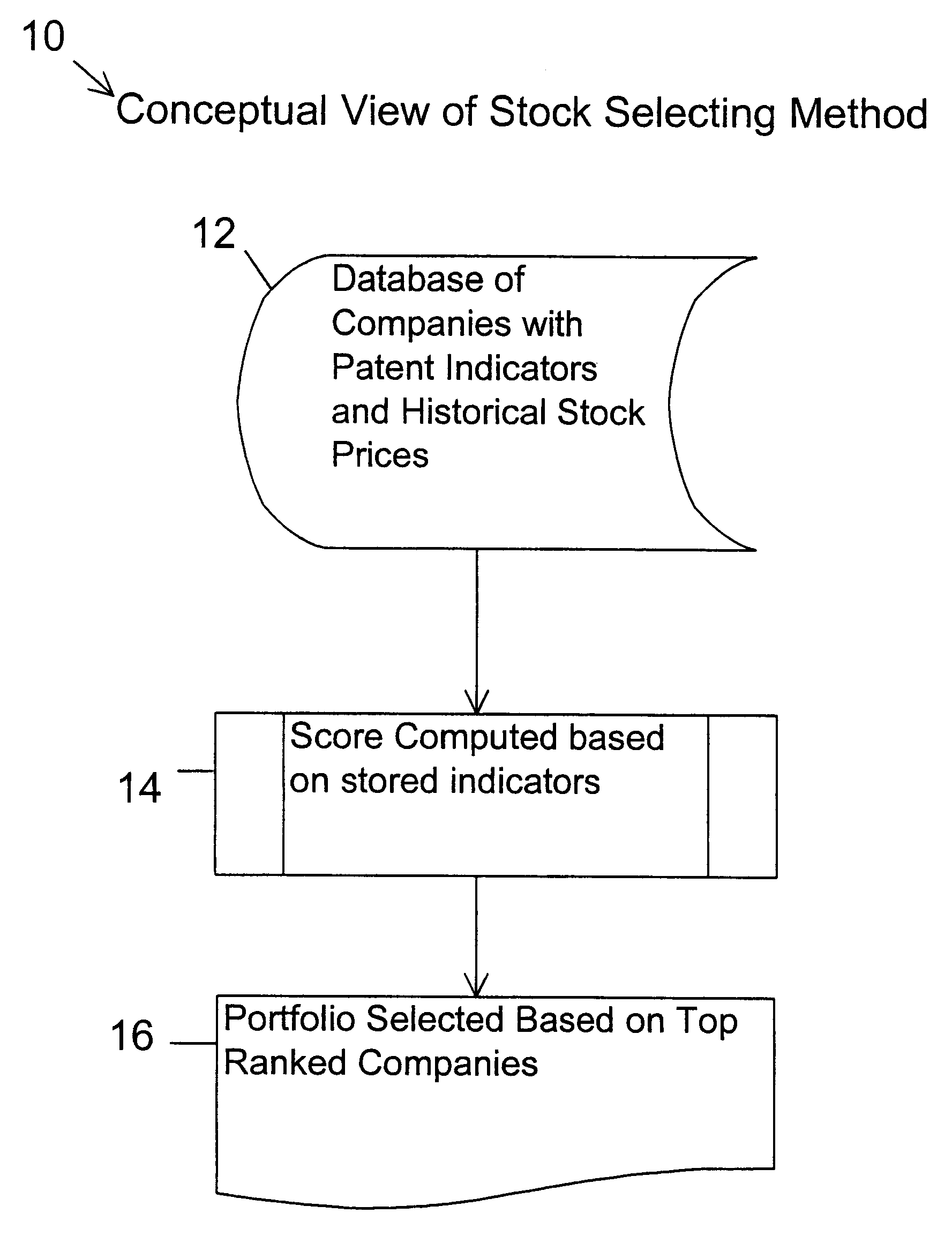

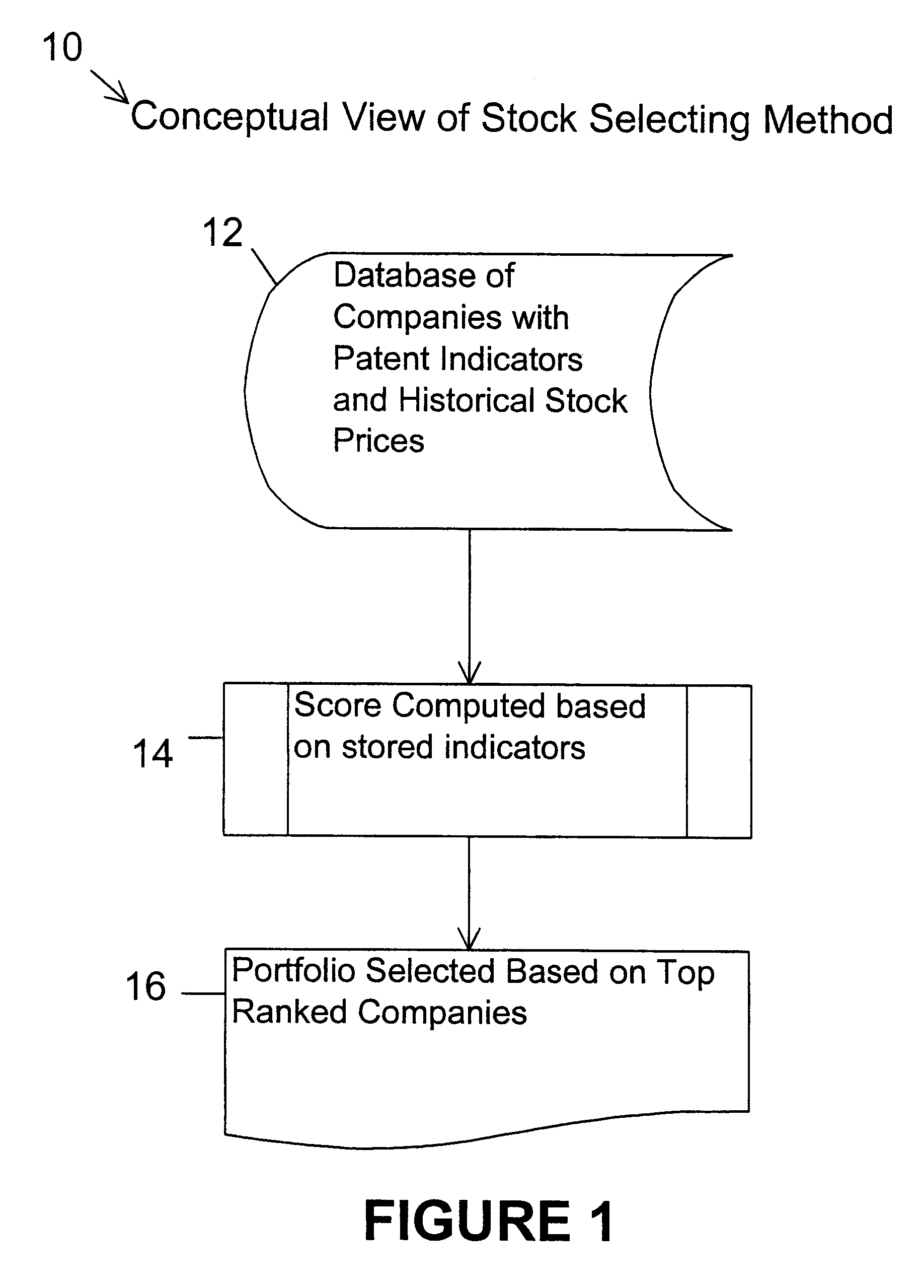

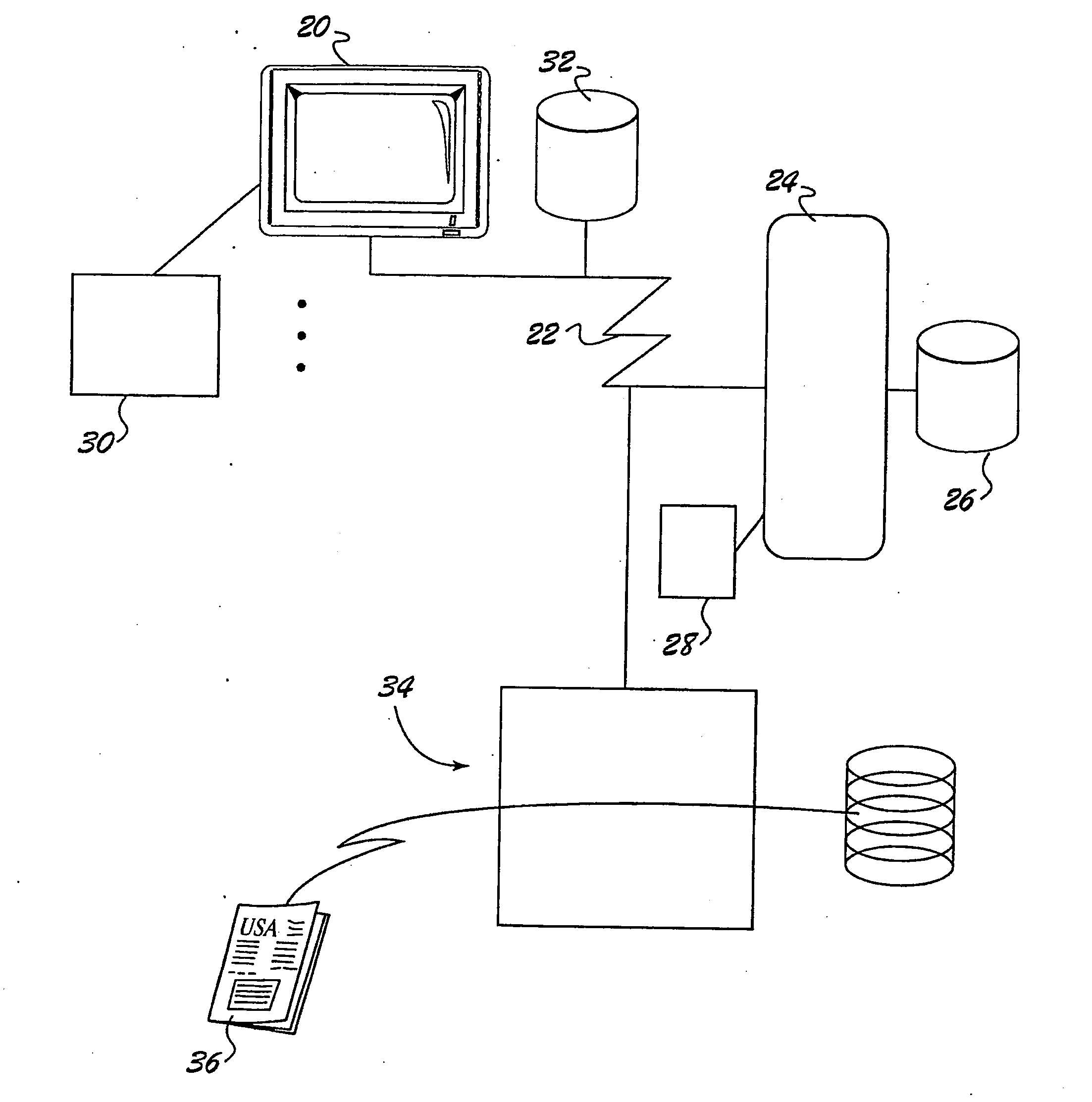

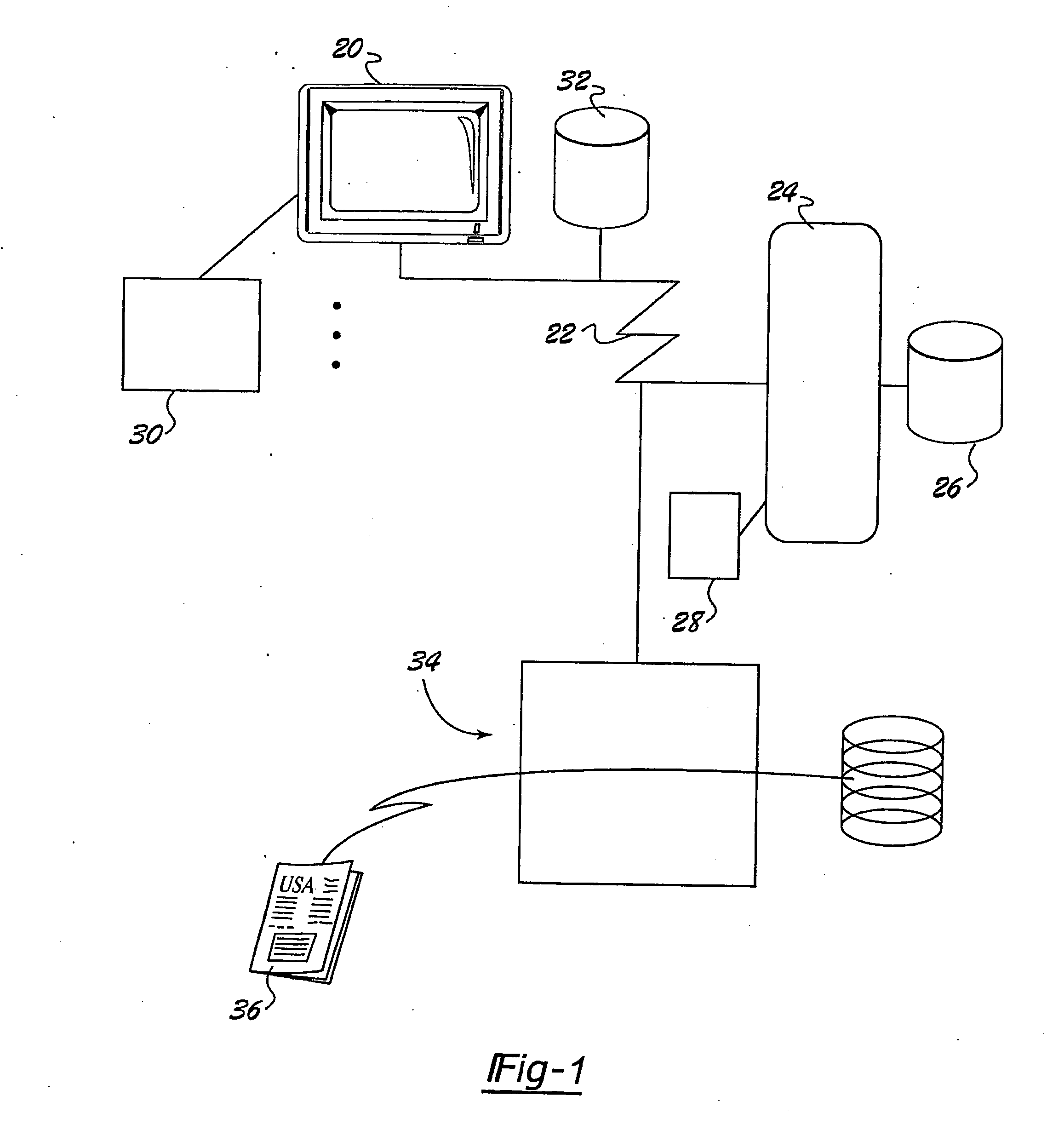

Method and apparatus for choosing a stock portfolio, based on patent indicators

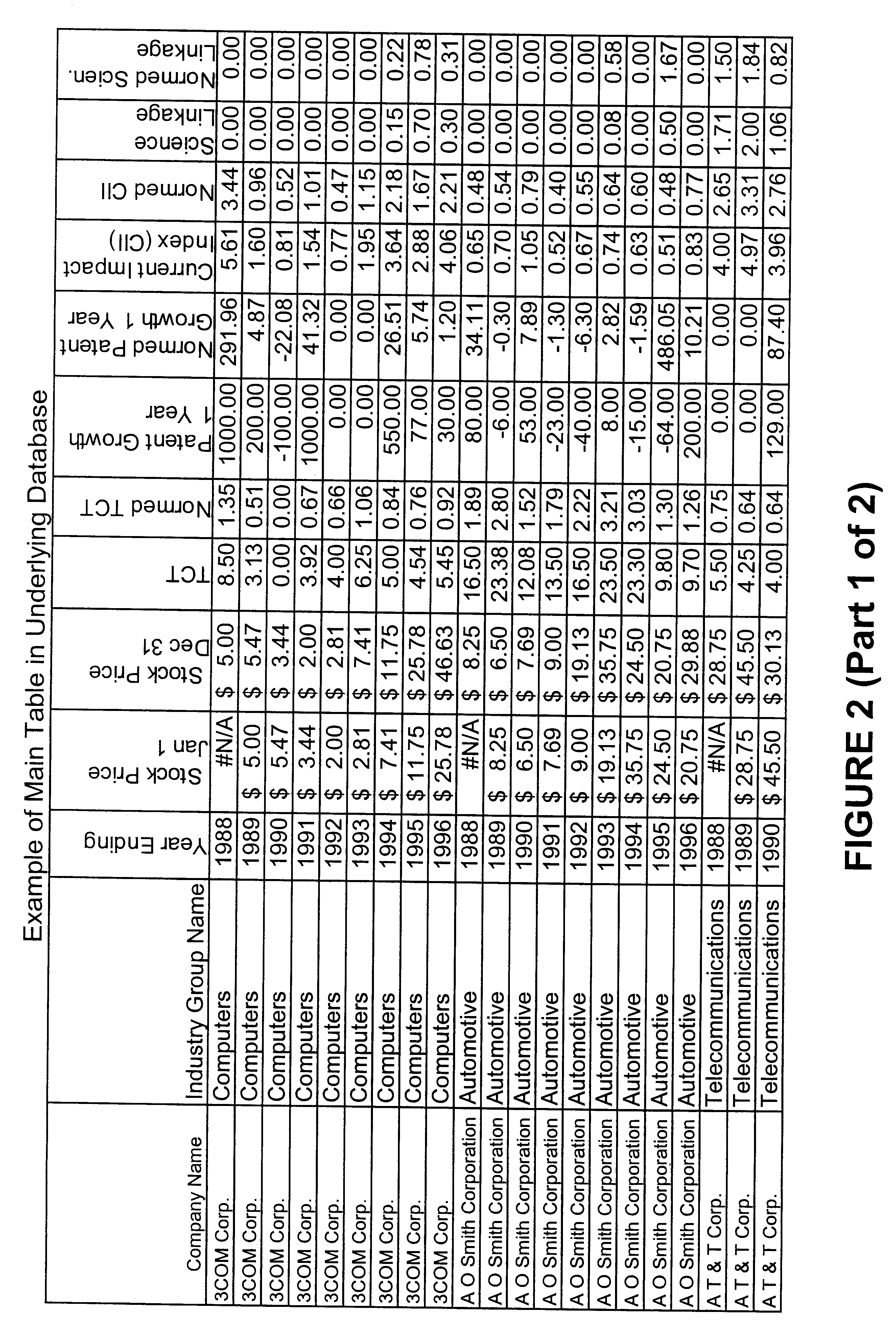

A portfolio selector technique is described for selecting publicly traded companies to include in a stock market portfolio. The technique is based on a technology score derived from the patent indicators of a set of technology companies with significant patent portfolios. Typical patent indicators may include citation indicators that measure the impact of patented technology on later technology, Technology Cycle Time that measures the speed of innovation of companies, and science linkage that measures leading edge tendencies of companies. Patent indicators measure the effect of quality technology on the company's future performance. The selector technique creates a scoring equation that weights each indicator such that the companies can be scored and ranked based on a combination of patent indicators. The score is then used to select the top ranked companies for inclusion in a stock portfolio. After a fixed period of time, as new patents are issued, the scores are recomputed such that the companies can be re-ranked and the portfolio adjusted to include new companies with higher scores and to eliminate companies in the current portfolio which have dropped in score. A portfolio of the top 10-25 companies using this method and a relatively simple scoring equation has been shown to greatly exceed the S&P 500 and other indexes in price gain over a ten year period.

Owner:CHI RES

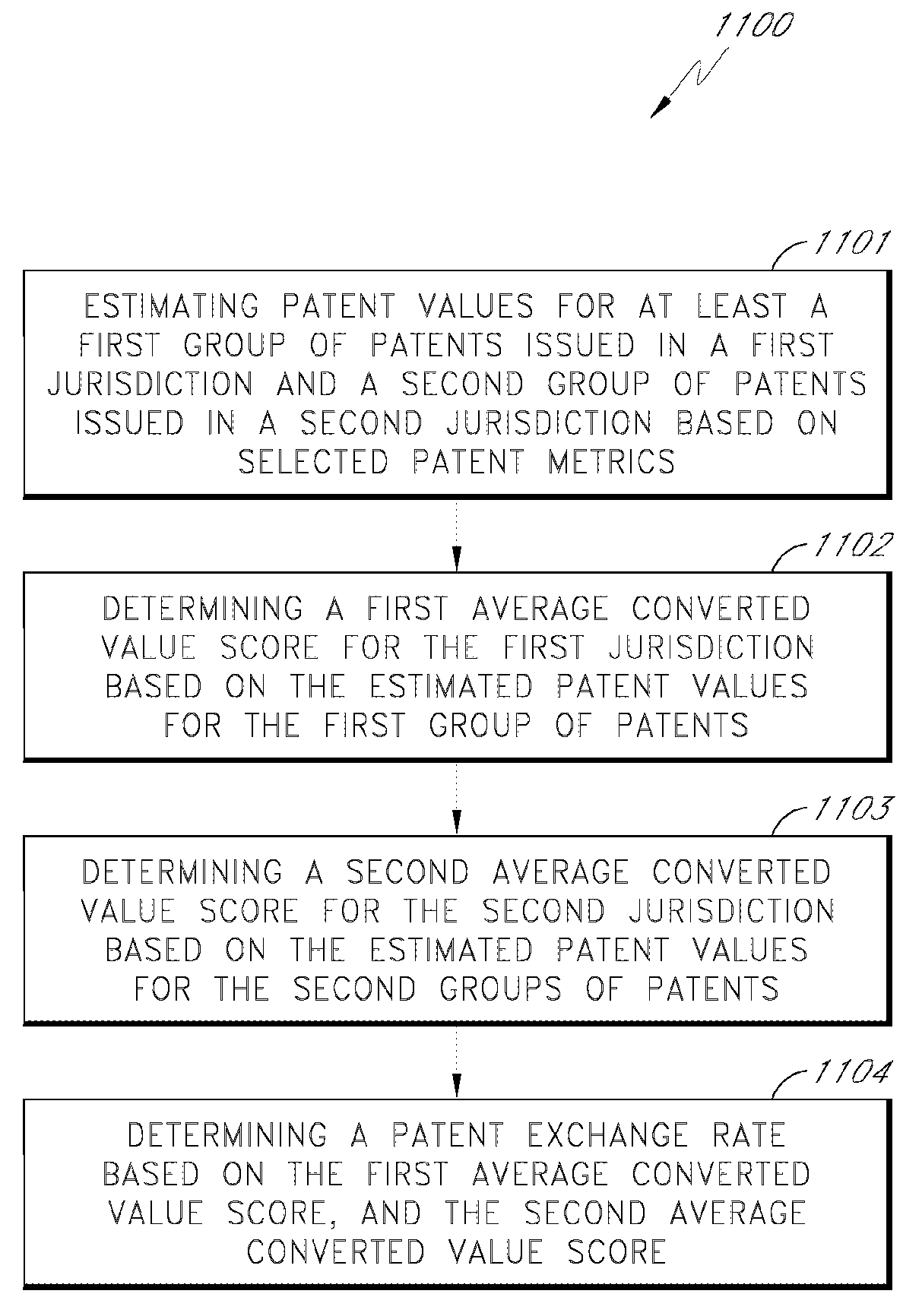

Method and system for valuing intangible assets

InactiveUS7657476B2Improve the level ofEliminate the effects ofFinanceProduct appraisalStatistical analysisSurvival analysis

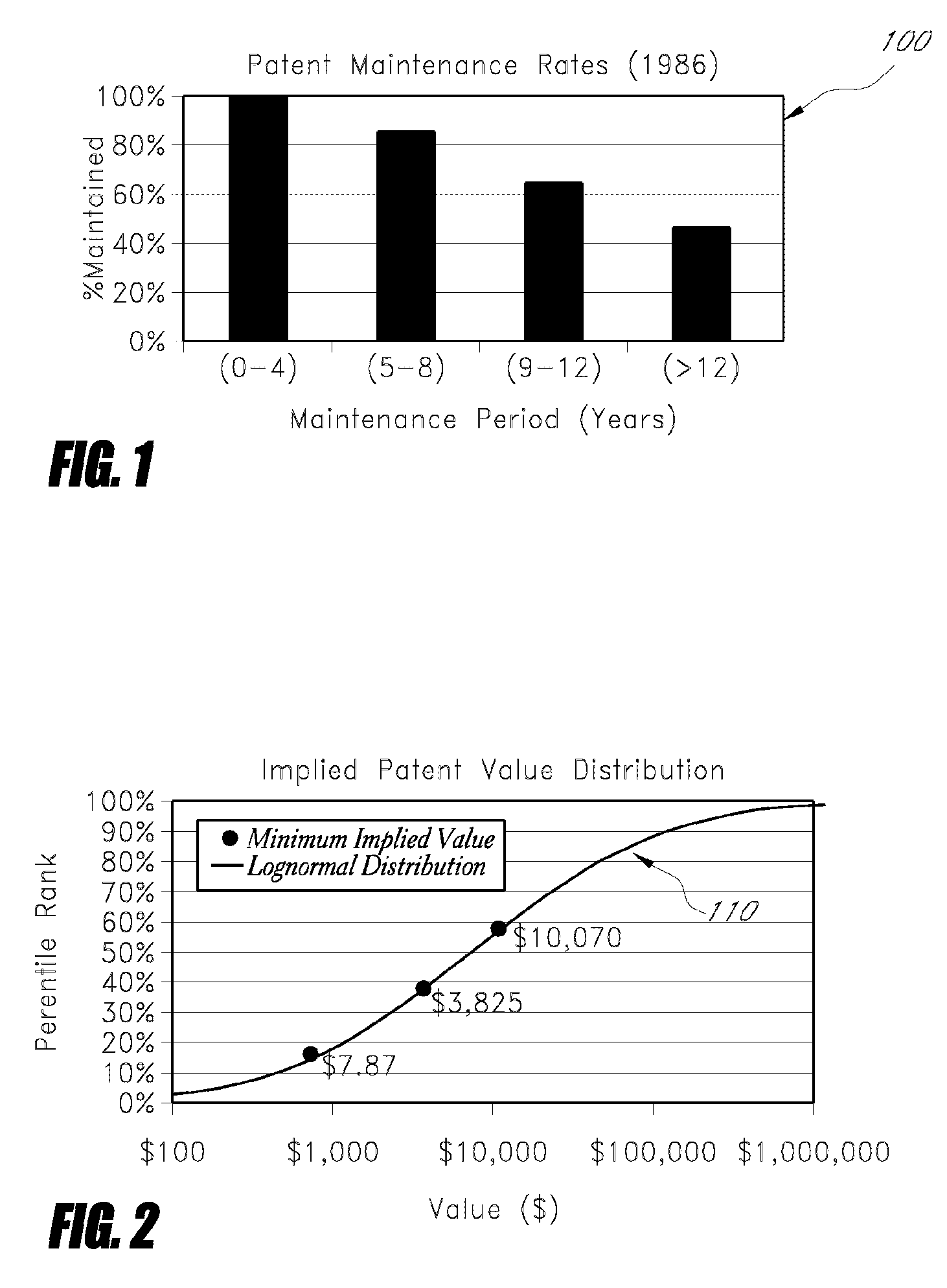

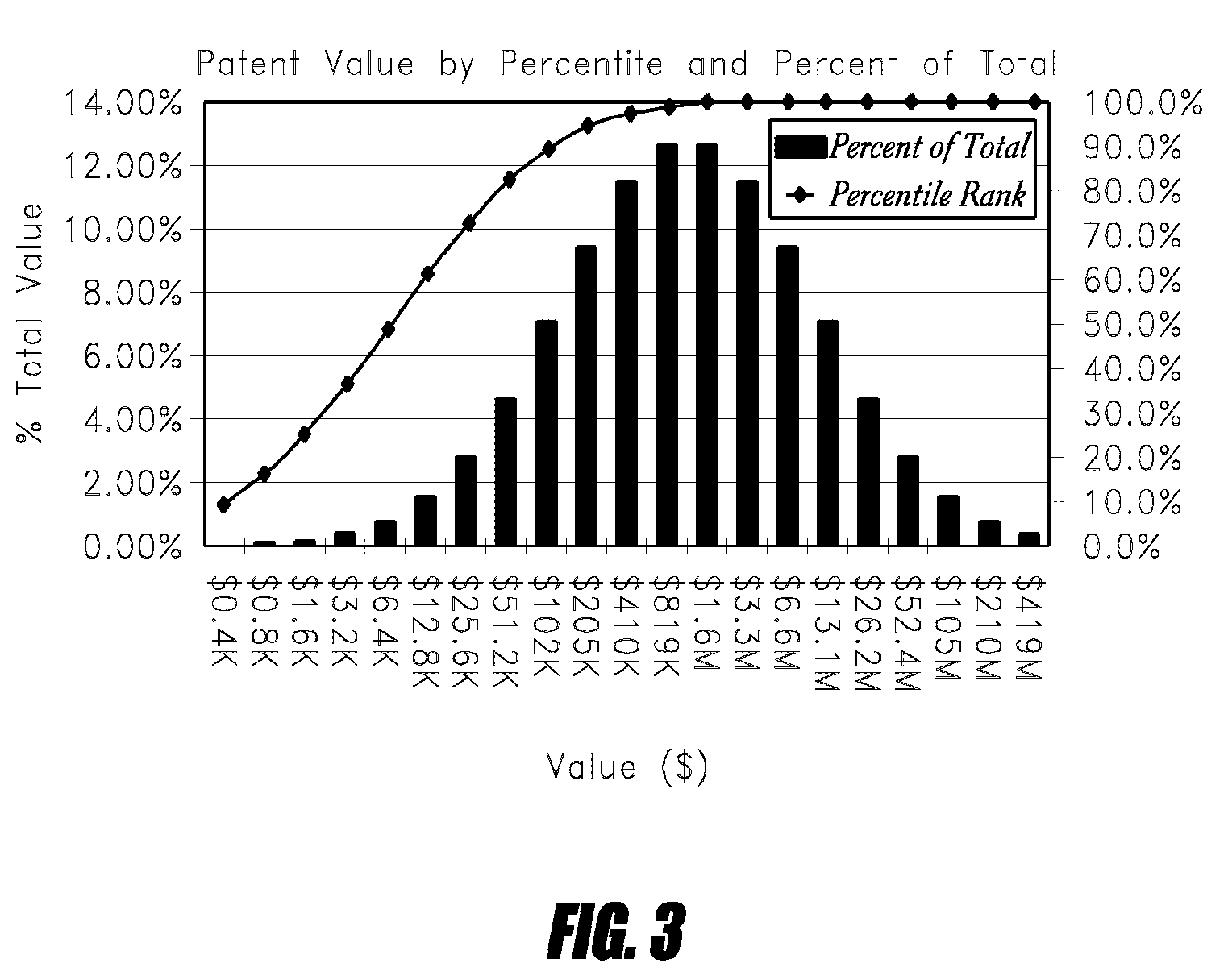

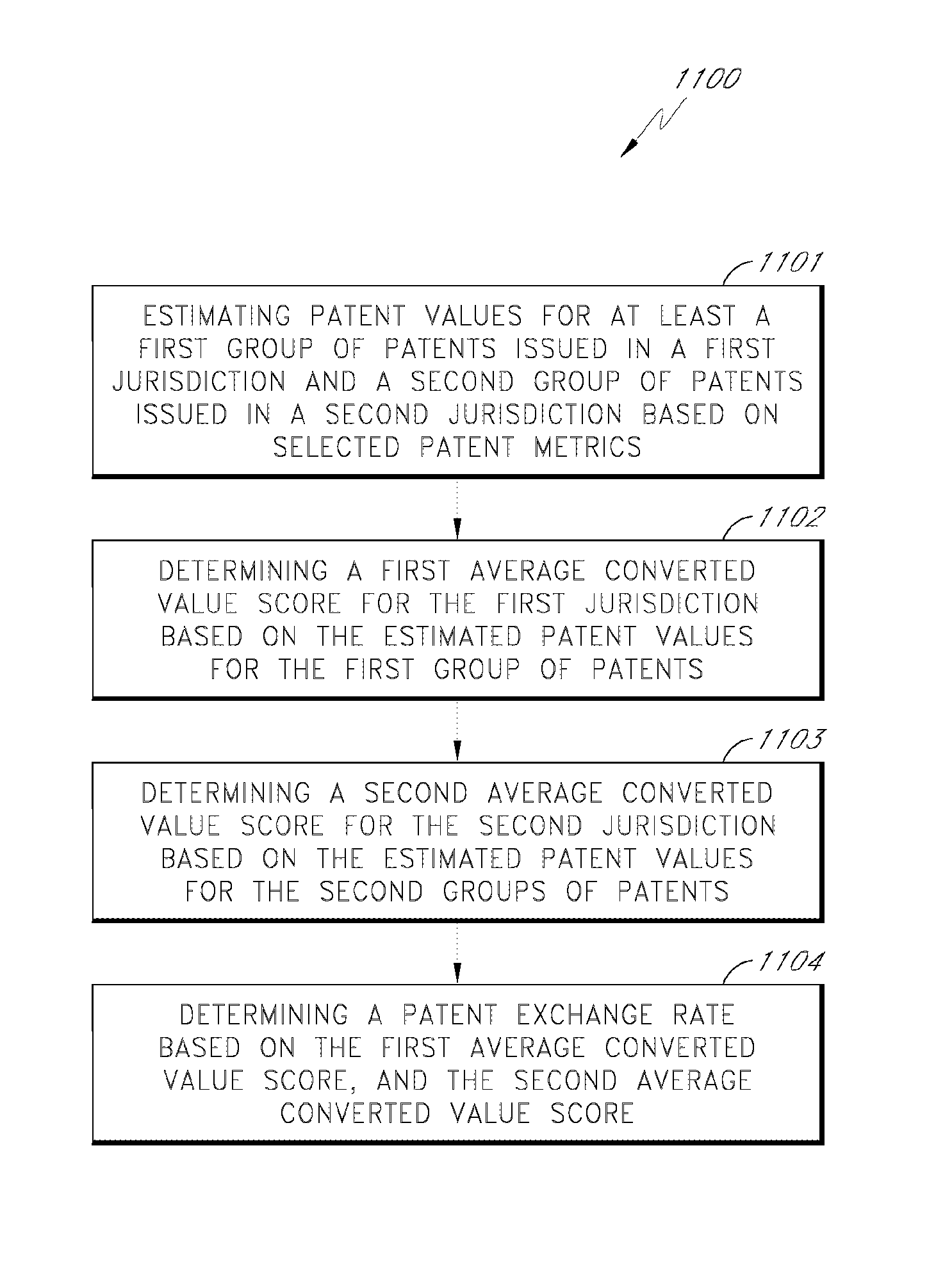

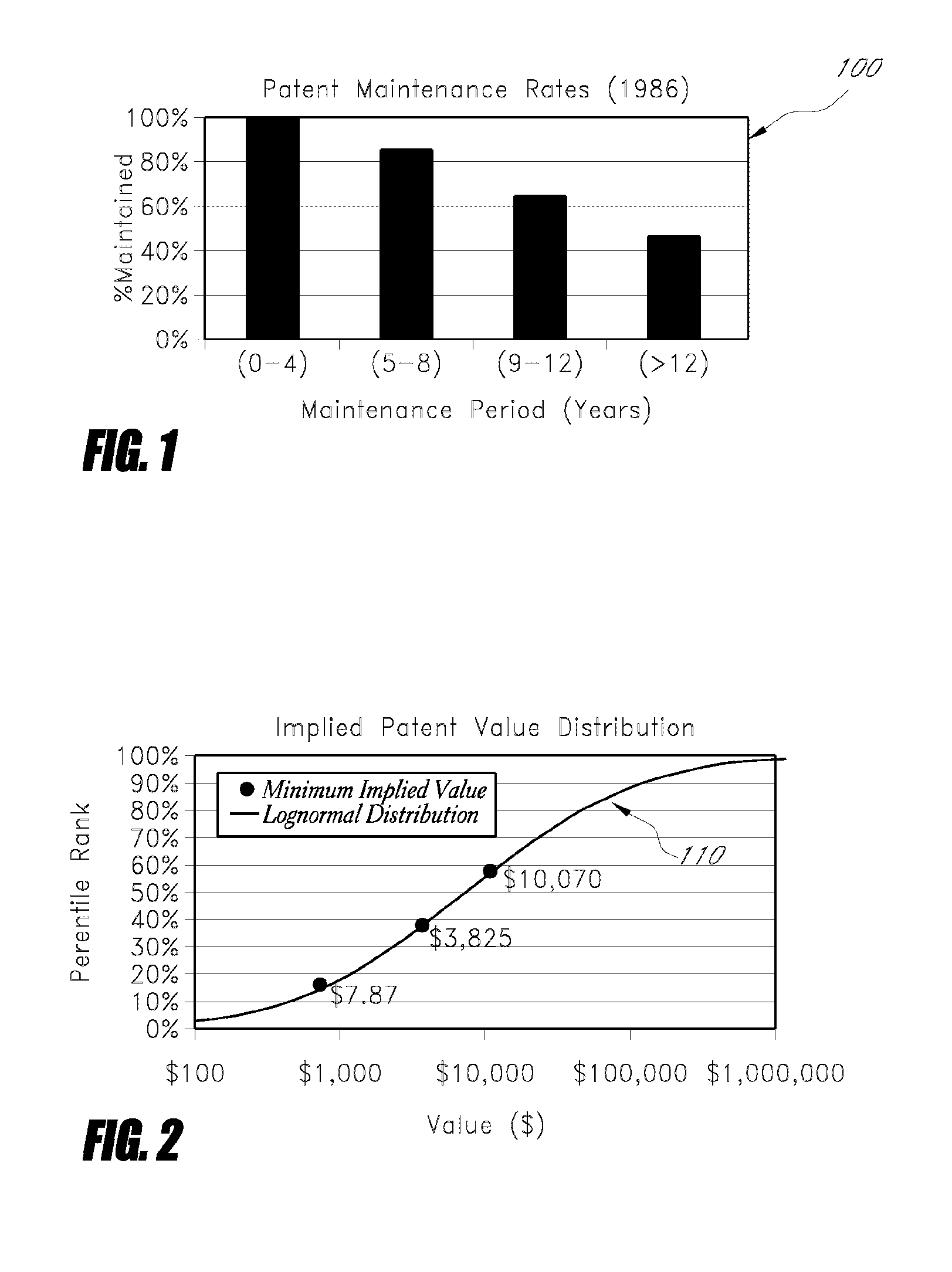

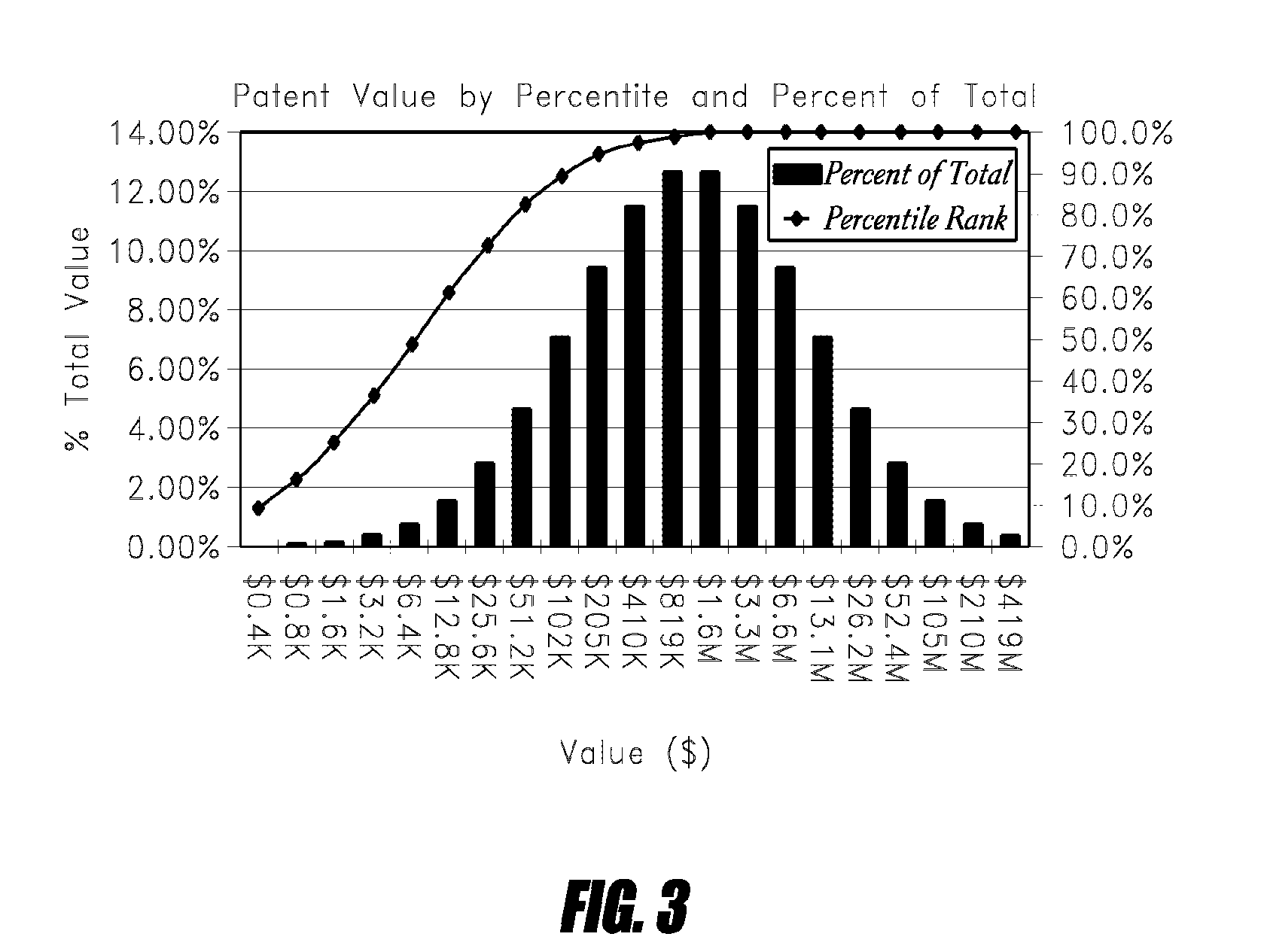

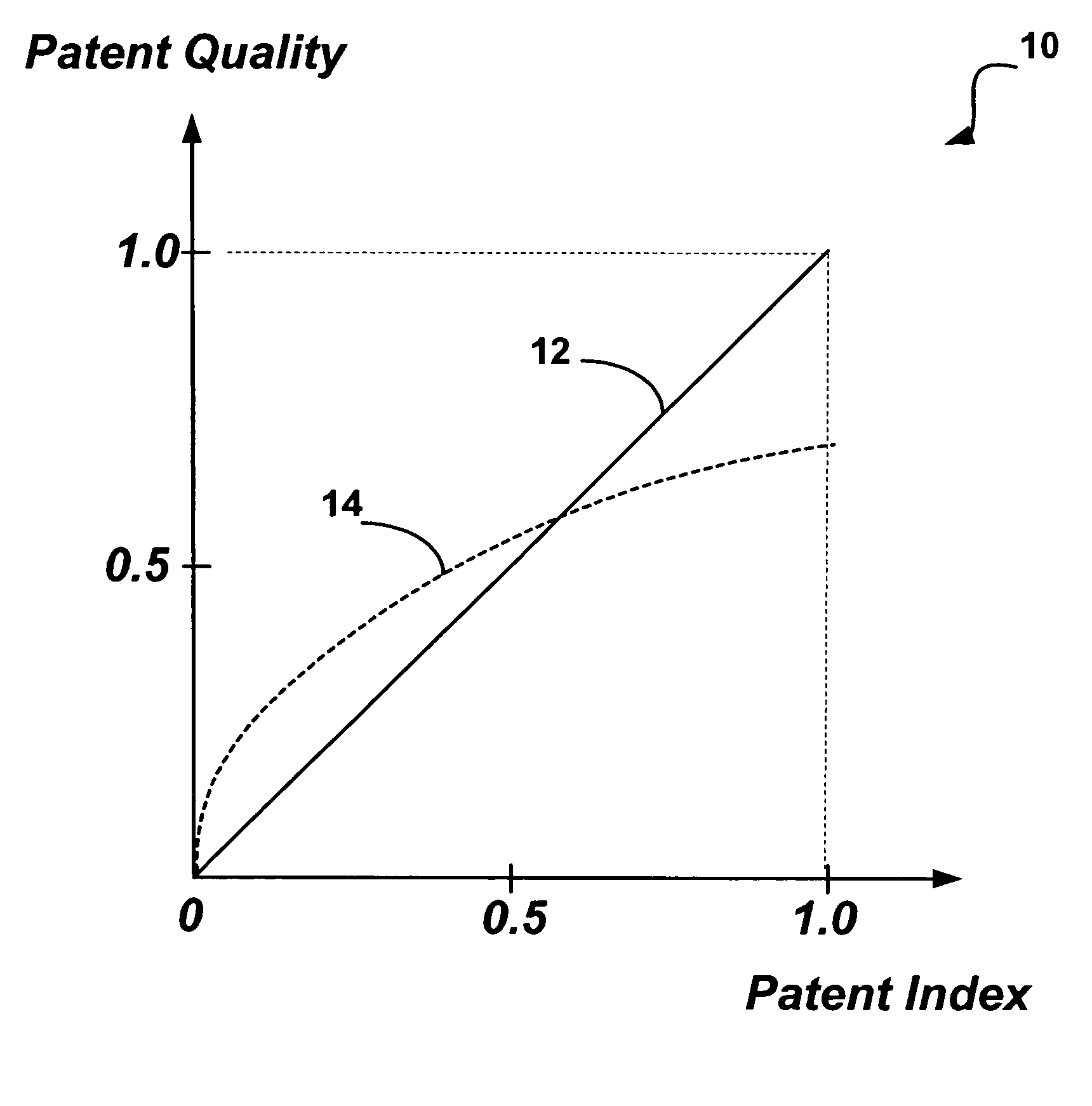

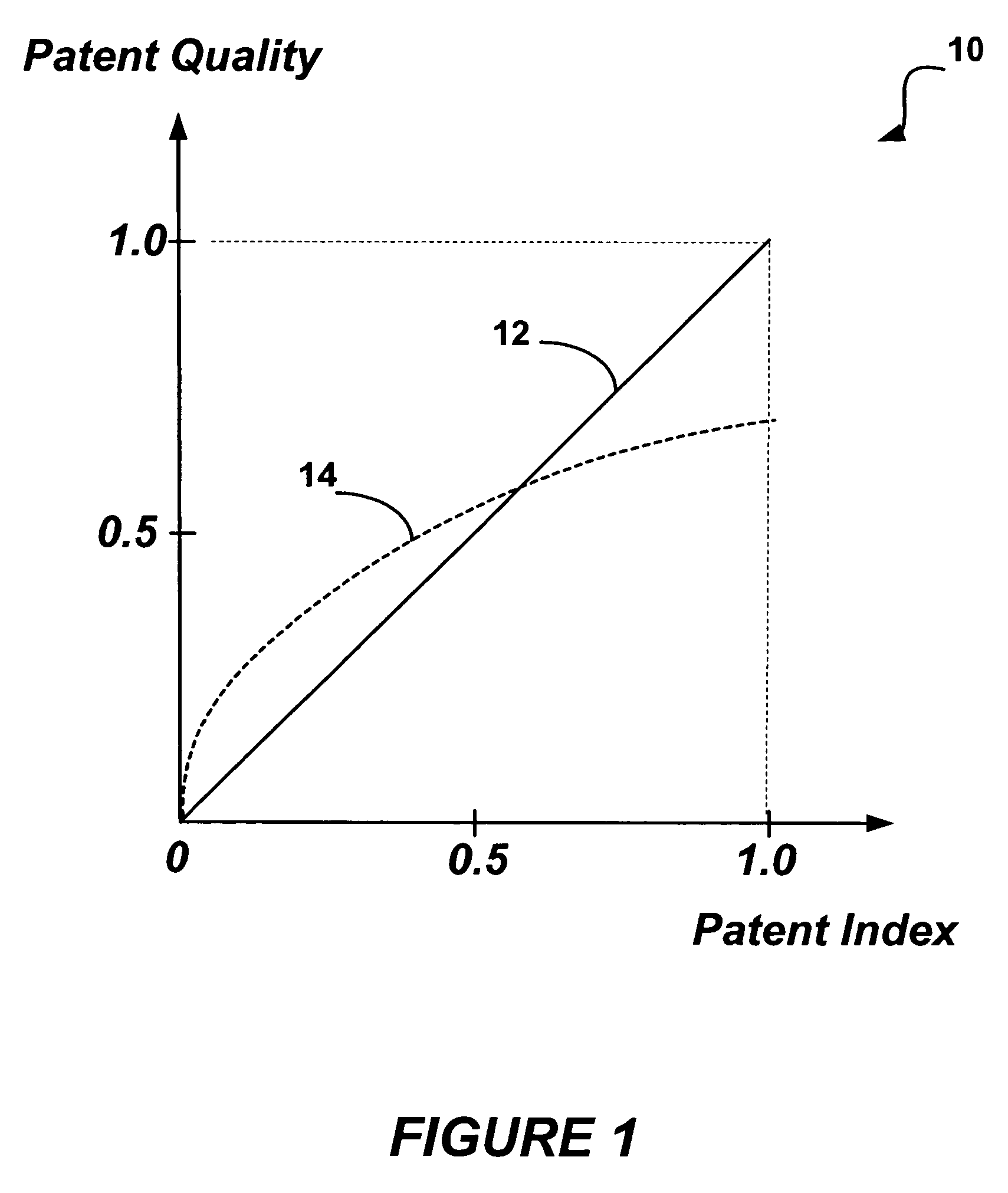

The present invention provides a method and system for valuing patent assets based on statistical survival analysis. An estimated value probability distribution curve is calculated for an identified group of patent assets using statistical analysis of PTO maintenance fee records. Expected valuations for individual patent assets are calculated based on a the value distribution curve and a comparative ranking or rating of individual patent assets relative to other patents in the group of identified patents. Patents having the highest percentile rankings would be correlated to the high end of the value distribution curve. Conversely, patents having the lowest percentile rankings would be correlated to the low end of the value distribution curve. Advantageously, such approach brings an added level of discipline to the overall valuation process in that the sum of individual patent valuations for a given patent population cannot exceed the total aggregate estimated value of all such patents. In this manner, fair and informative valuations can be provided based on the relative quality of the patent asset in question without need for comparative market data of other patents or patent portfolios, and without need for a demonstrated (or hypothetical) income streams for the patent in question. Estimated valuations are based simply on the allocation of a corresponding portion of the overall patent value “pie” as represented by each patents' relative ranking or position along a value distribution curve.

Owner:PATENTRATINGS

System and method for patent portfolio evaluation

InactiveUS20060036452A1Consistent resultFriendly graphical user interfaceFinanceEngineeringLighting spectrum

Methods and systems for forming a team of experts and evaluating a portfolio of patent documents have been provided. The methods comprise the step of determining a bias of an expert, and then providing evaluations of patent documents assigned to the expert according to a selected evaluation method, which is bias corrected to reduce or compensate for the bias of the expert. A system for evaluating a patent portfolio comprises means for assigning the patent documents to said experts and monitoring progress of the evaluation process of each expert, and means for performing evaluations of the assigned patent documents by each expert. The system is further enhanced with the means for determining the bias of the expert, and with a 10 visualization unit for visualizing the results of the patent portfolio evaluation by color coding the evaluation results, wherein patent documents having different values are represented by different colors of a visible part of the light spectrum. A corresponding computer program product, a computer memory and a web site for providing access to the system and management of activities of the experts are also described.

Owner:WILLIAMS ALLAN

Method and system for valuing intangible assets

InactiveUS20070150298A1Eliminate the effects ofImprove the level ofFinanceProduct appraisalSurvival analysisStatistical analysis

The present invention provides a method and system for valuing patent assets based on statistical survival analysis. An estimated value probability distribution curve is calculated for an identified group of patent assets using statistical analysis of PTO maintenance fee records. Expected valuations for individual patent assets are calculated based on a the value distribution curve and a comparative ranking or rating of individual patent assets relative to other patents in the group of identified patents. Patents having the highest percentile rankings would be correlated to the high end of the value distribution curve. Conversely, patents having the lowest percentile rankings would be correlated to the low end of the value distribution curve. Advantageously, such approach brings an added level of discipline to the overall valuation process in that the sum of individual patent valuations for a given patent population cannot exceed the total aggregate estimated value of all such patents. In this manner, fair and informative valuations can be provided based on the relative quality of the patent asset in question without need for comparative market data of other patents or patent portfolios, and without need for a demonstrated (or hypothetical) income streams for the patent in question. Estimated valuations are based simply on the allocation of a corresponding portion of the overall patent value “pie” as represented by each patents' relative ranking or position along a value distribution curve

Owner:PATENTRATINGS

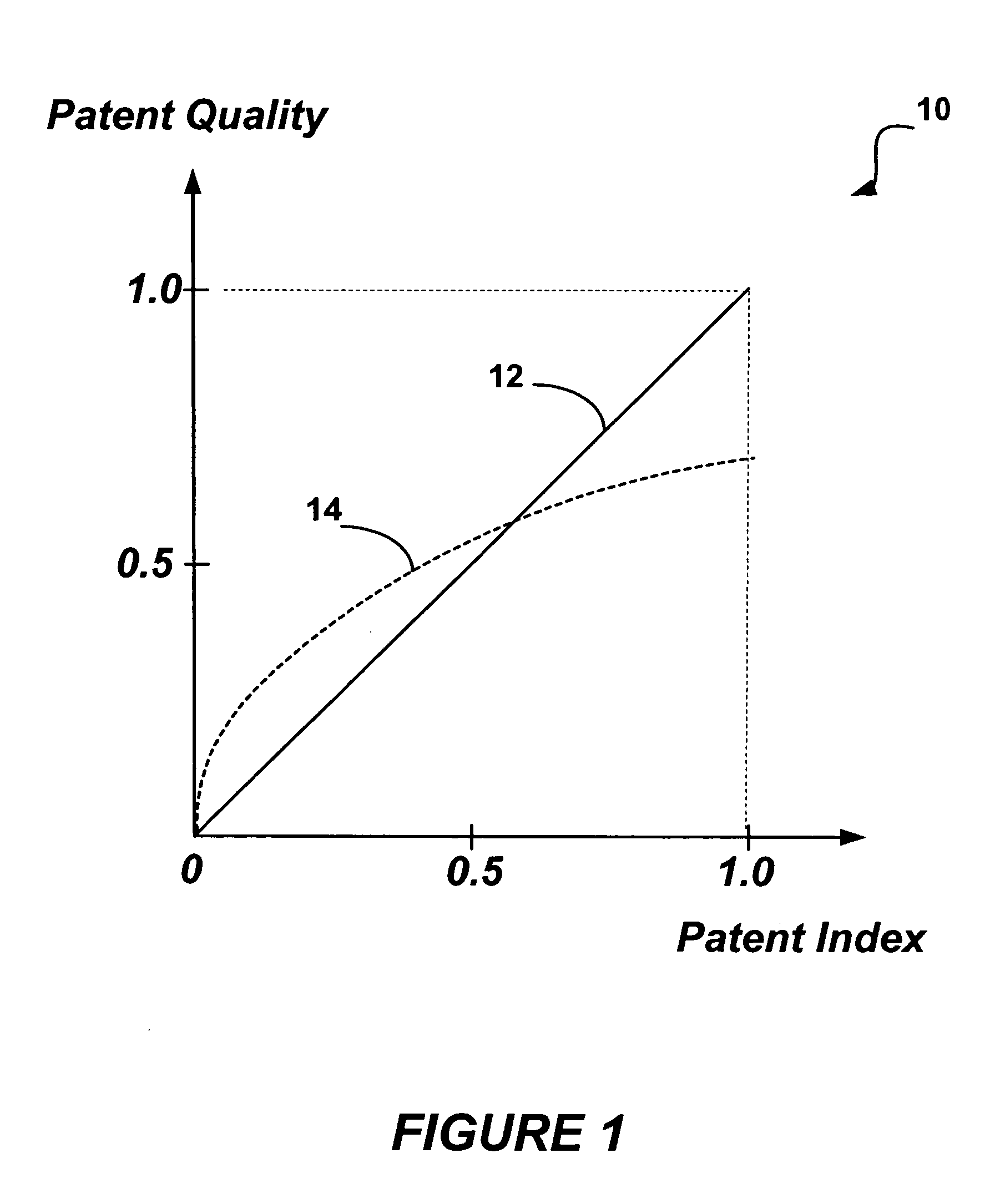

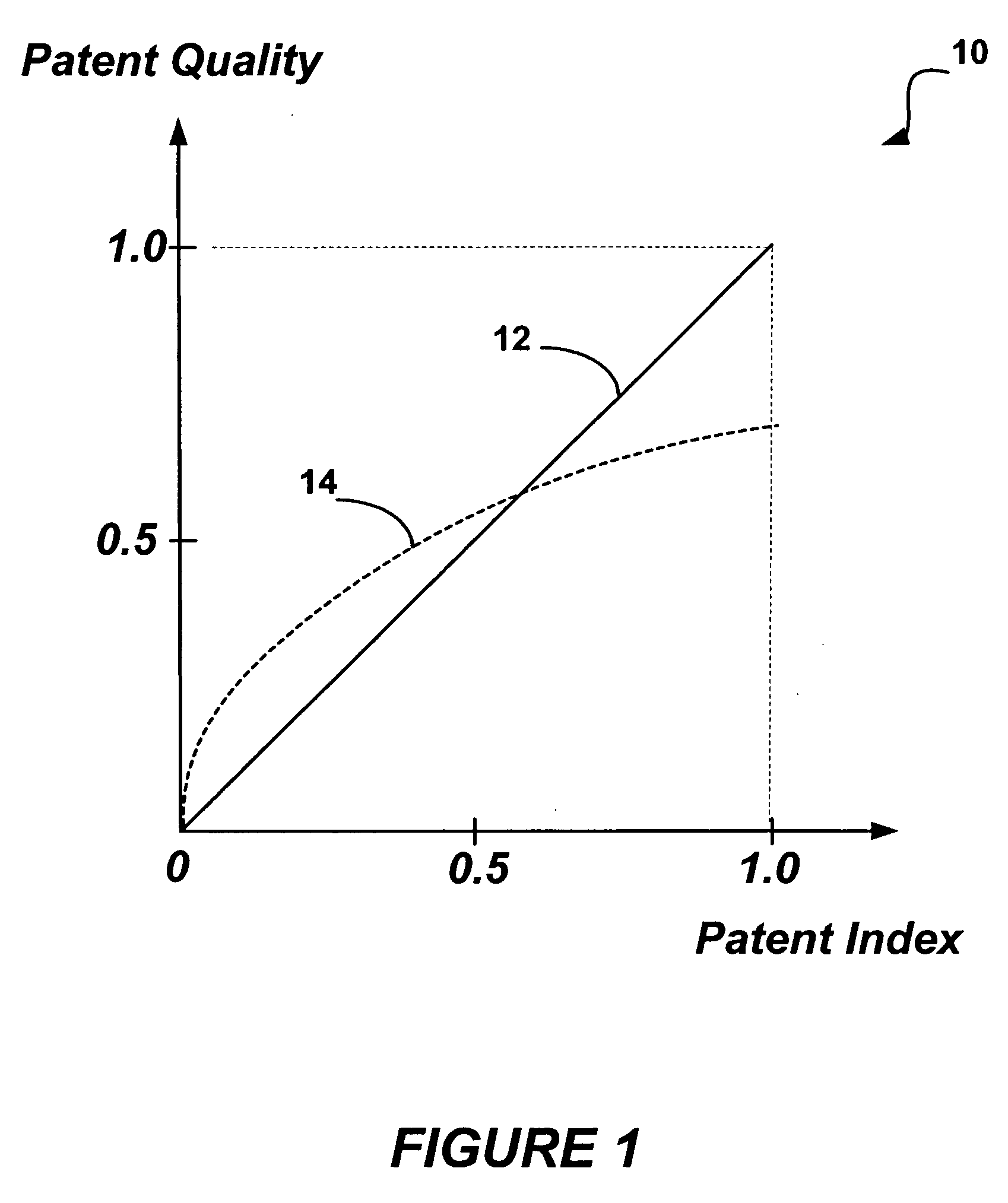

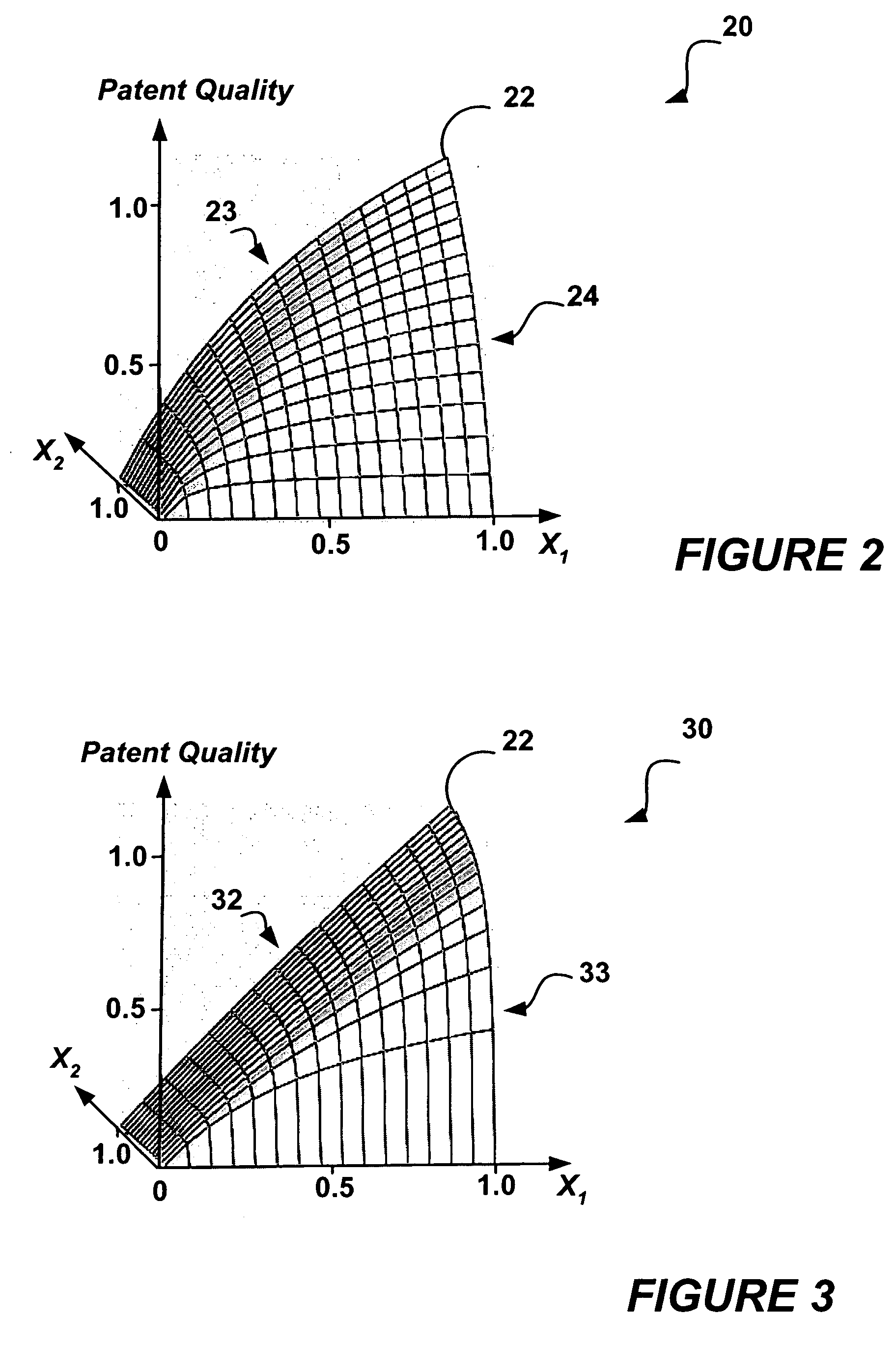

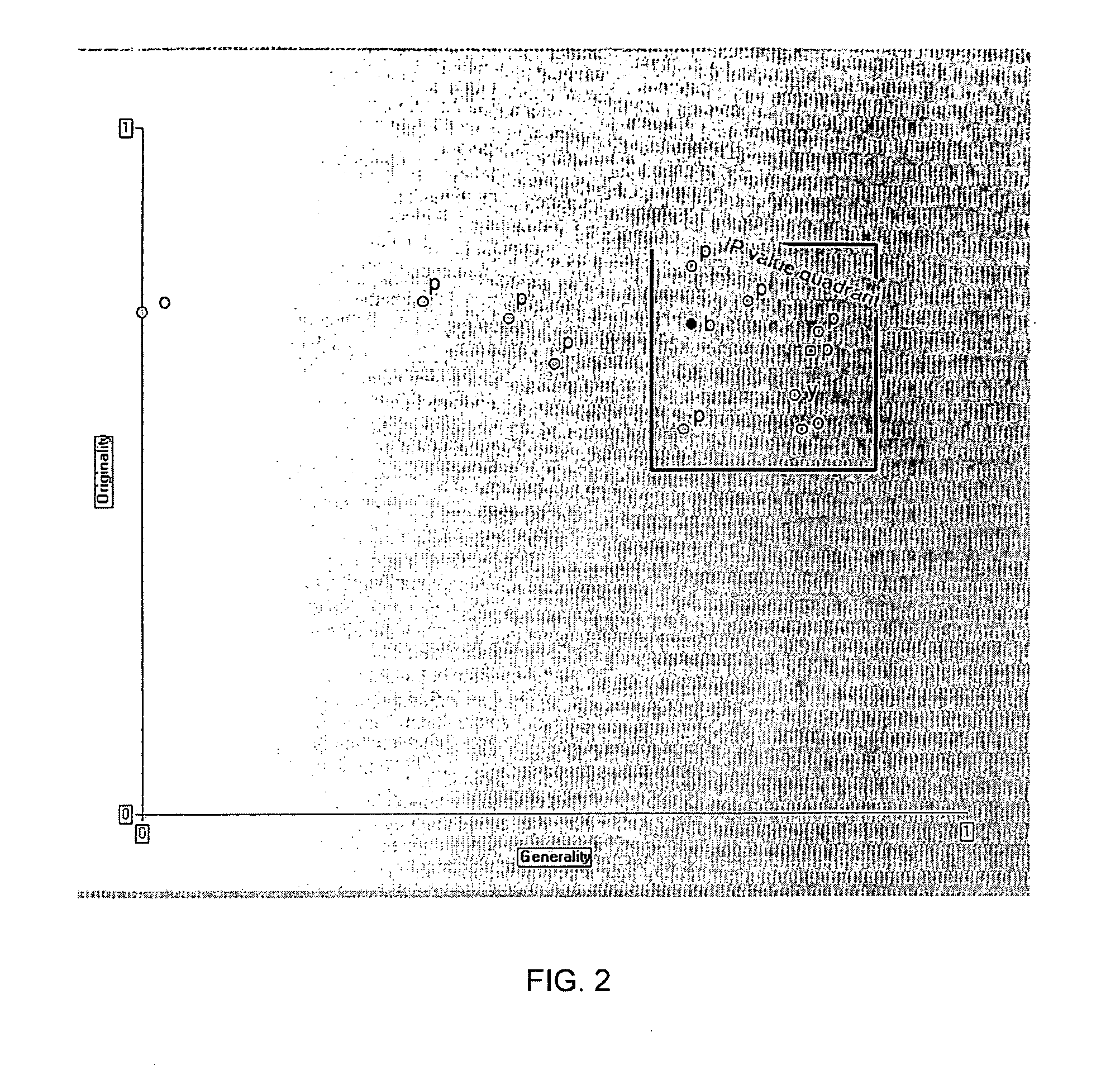

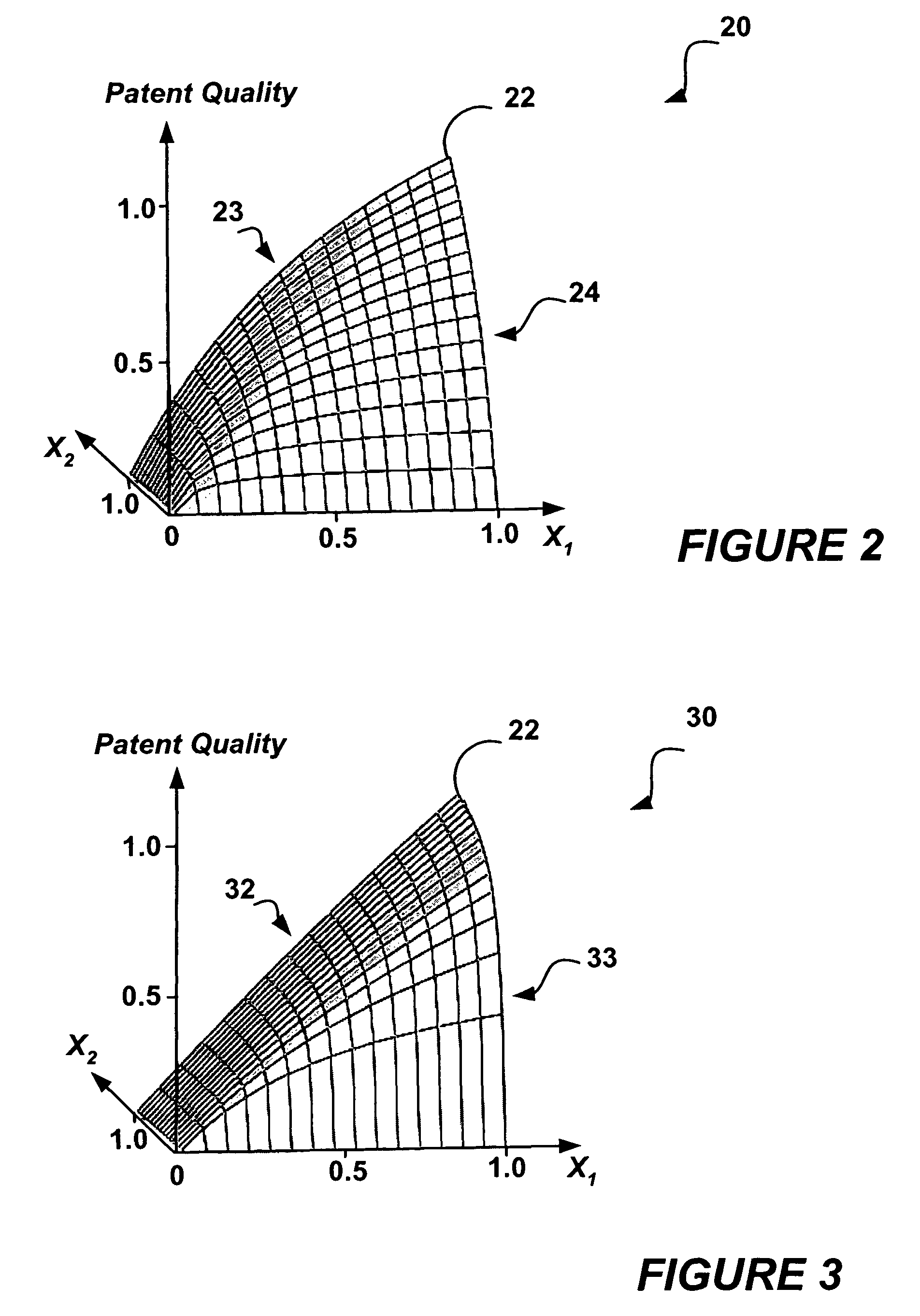

System and method for patent evaluation and visualization of the results thereof

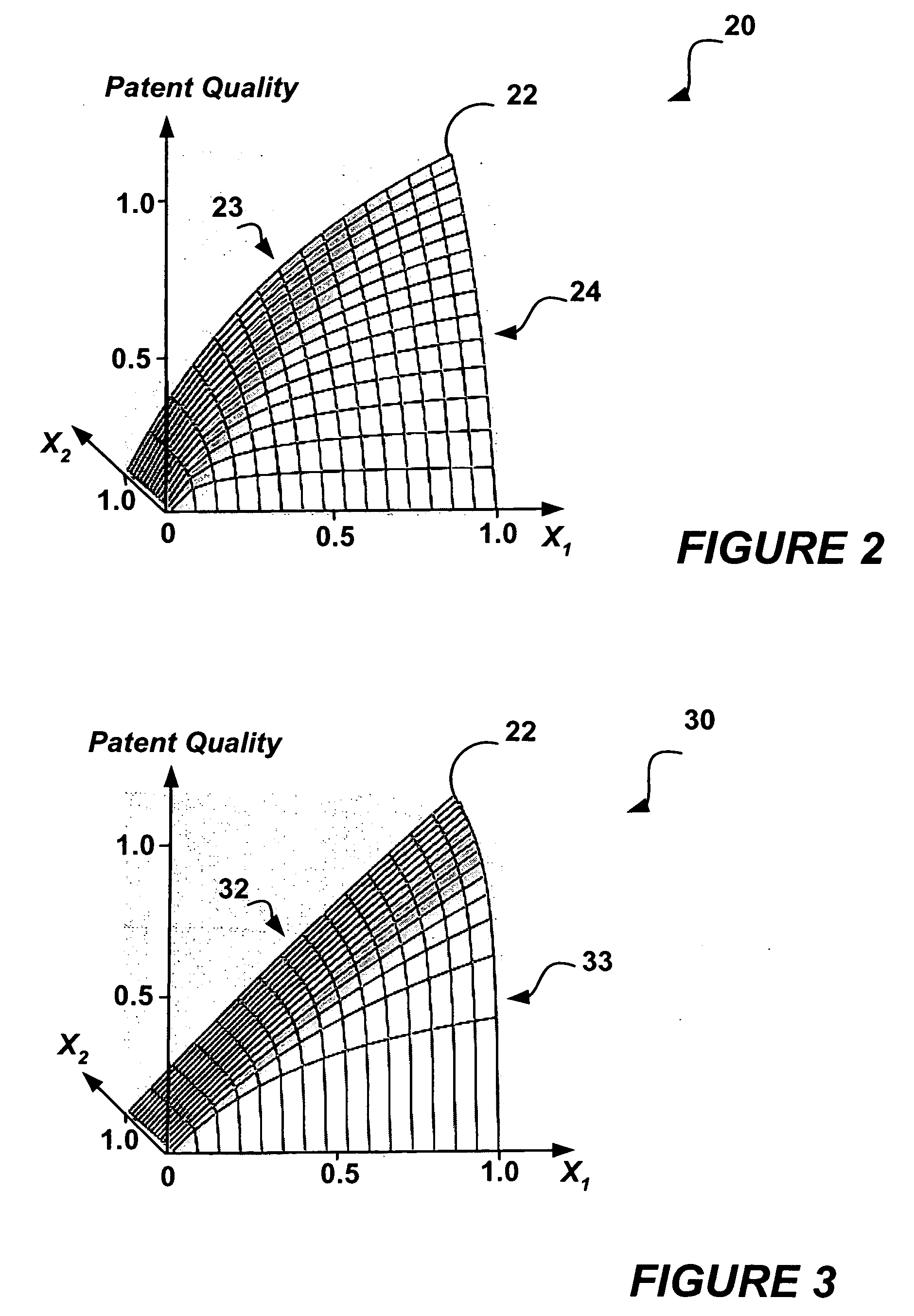

A method for evaluating a patent document is described, which includes the steps of introducing a set of one or more patent indices, characterizing different aspects of the patent document; combining said patent indices into a Patent Quality index (the PQ), characterizing value of the patent document; and visualizing the value of the patent document by using a color coding of the patent document according to the value of the PQ index. Conveniently, a correspondence between the value of the Patent Quality index of the patent document and the wavelength of a selected color of a visible part of the light spectrum is provided. A corresponding method and system for visualizing results of evaluation of a patent portfolio are described, wherein the value of the patent portfolio is visually displayed as a color cloud in a system of coordinates having axes corresponding to the patent indices, the value of each patent document (the respective PQ index) being displayed as a color point, which coordinates are equal to the values of their respective patent indices, and the colors of the color points are selected in accordance with the values of their PQ indices.

Owner:WILLIAMS ALLAN

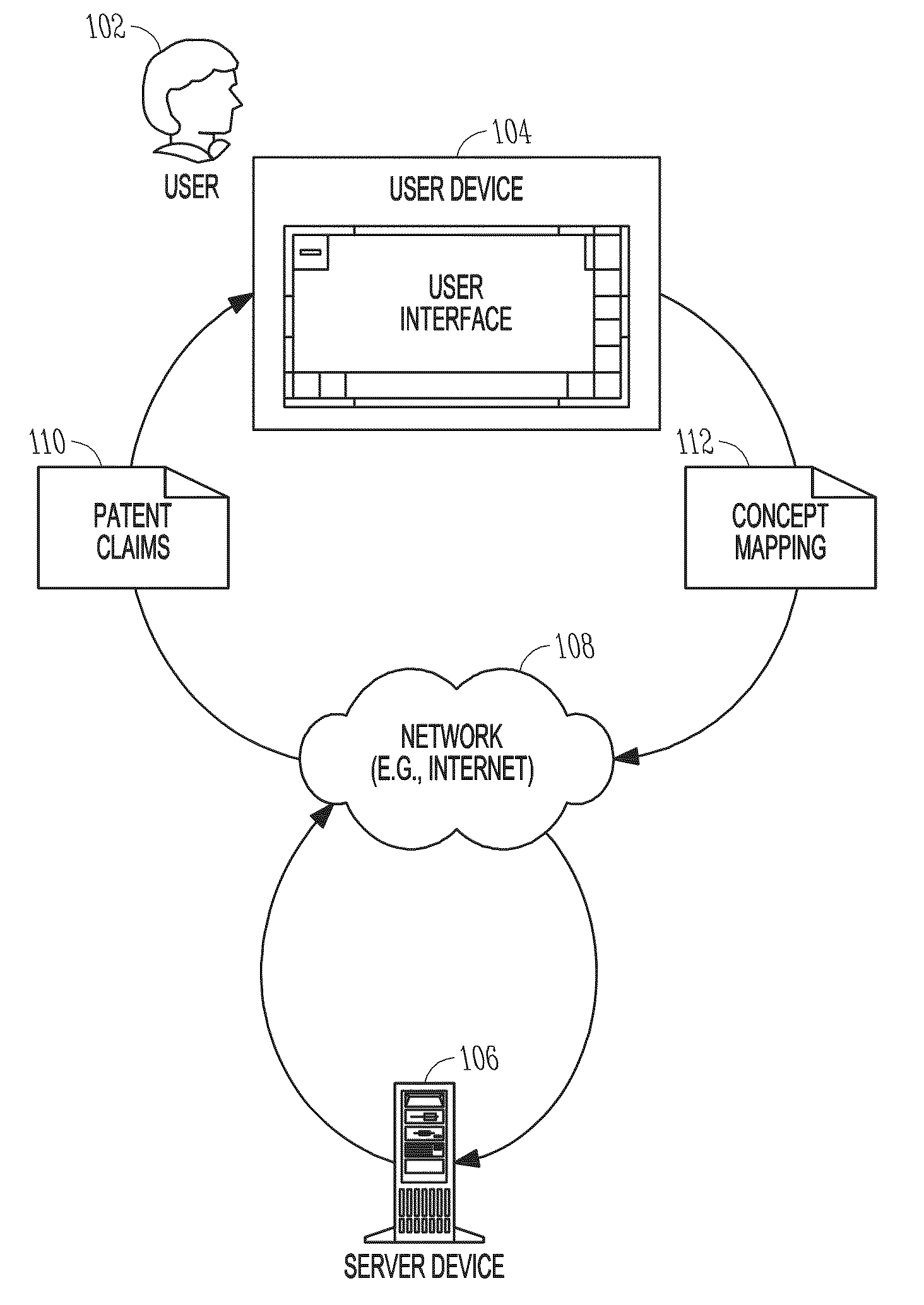

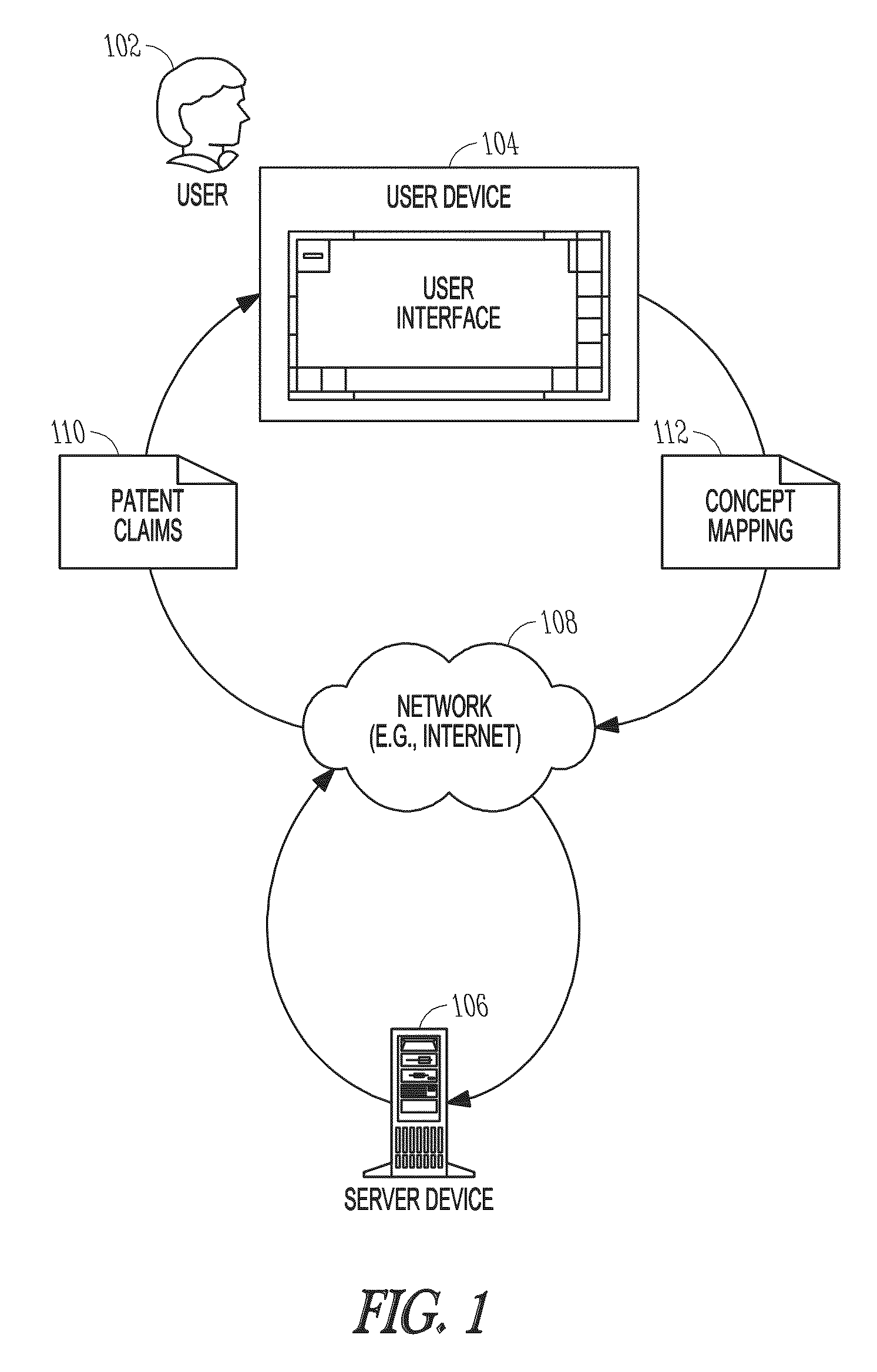

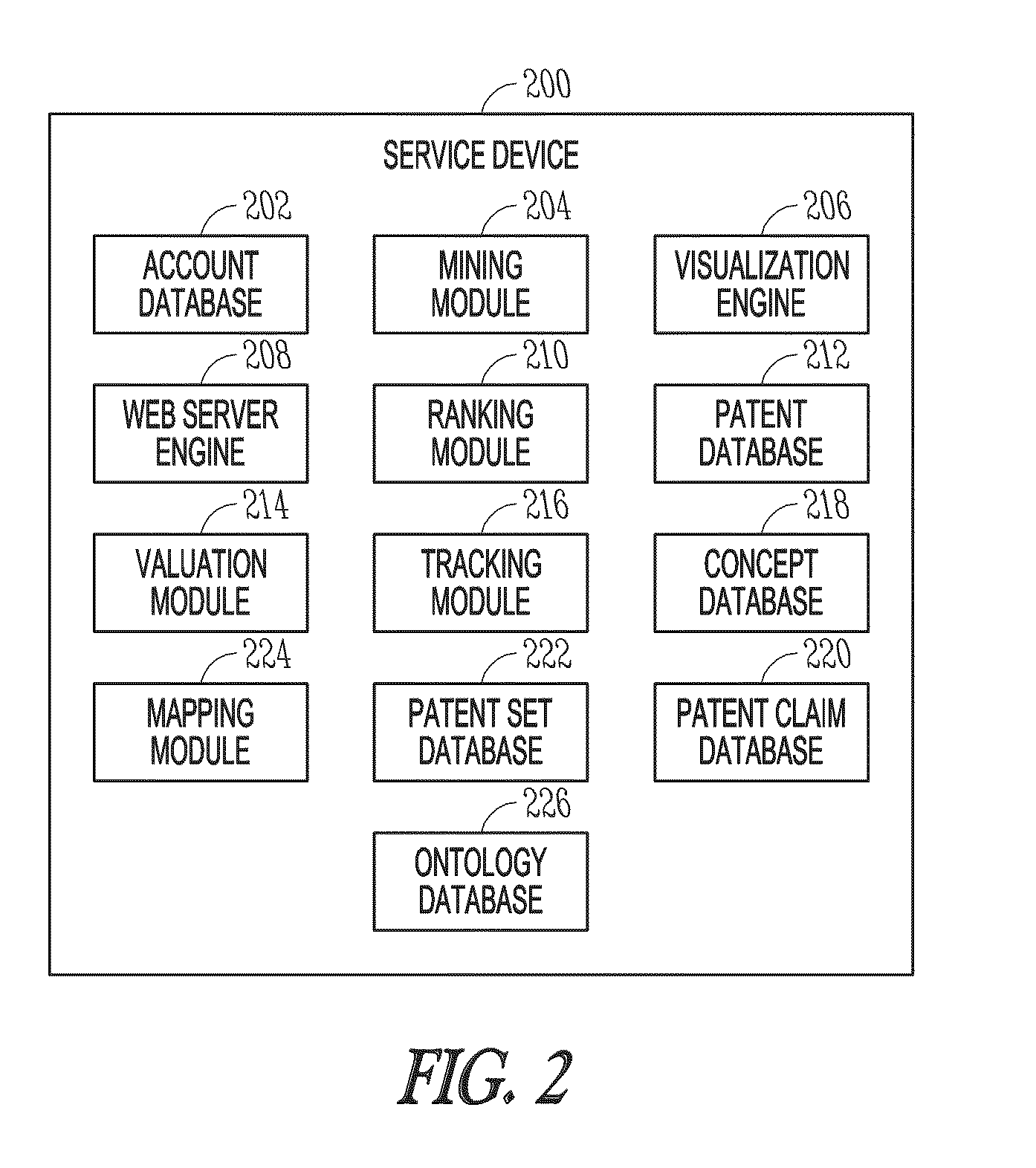

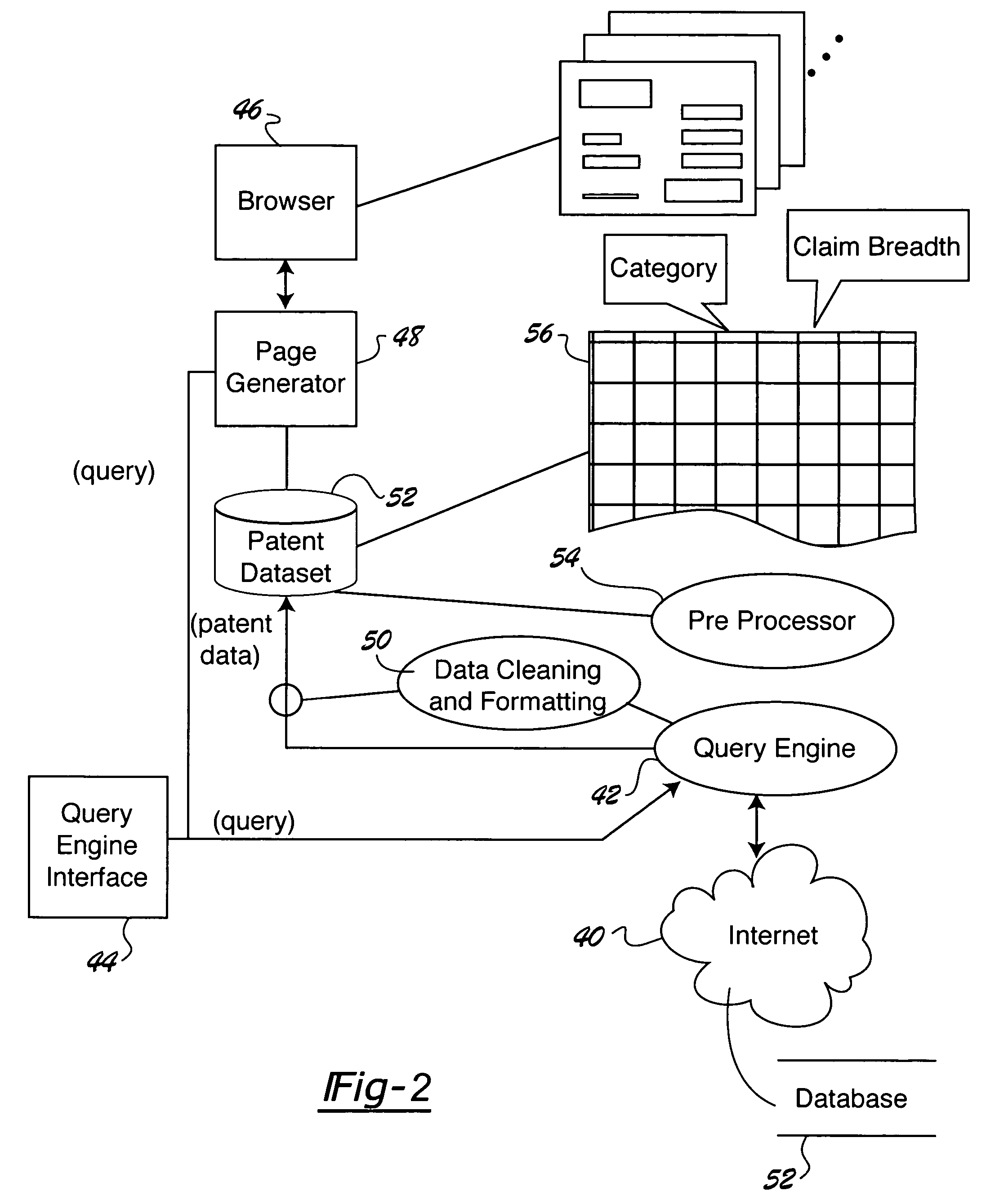

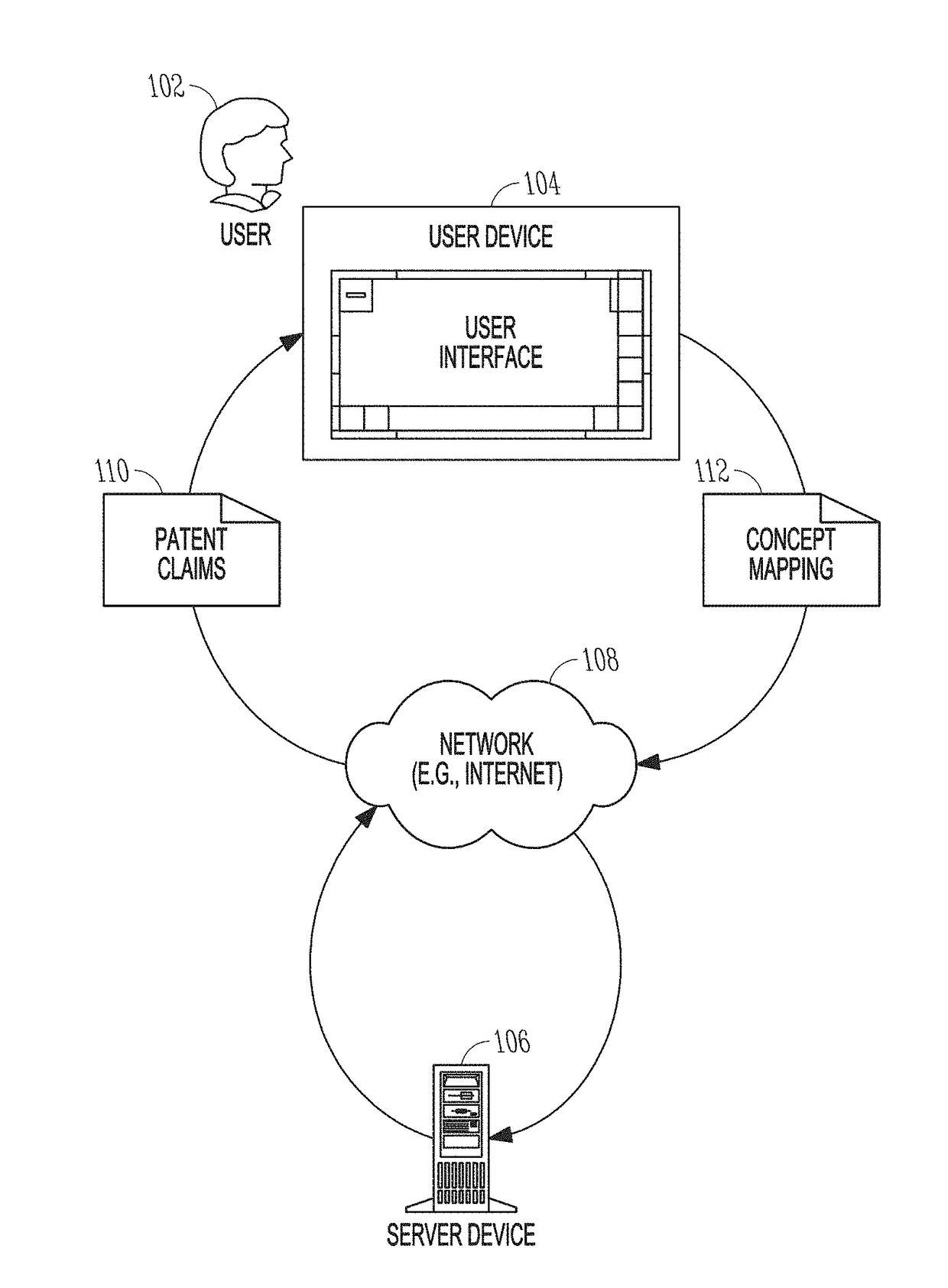

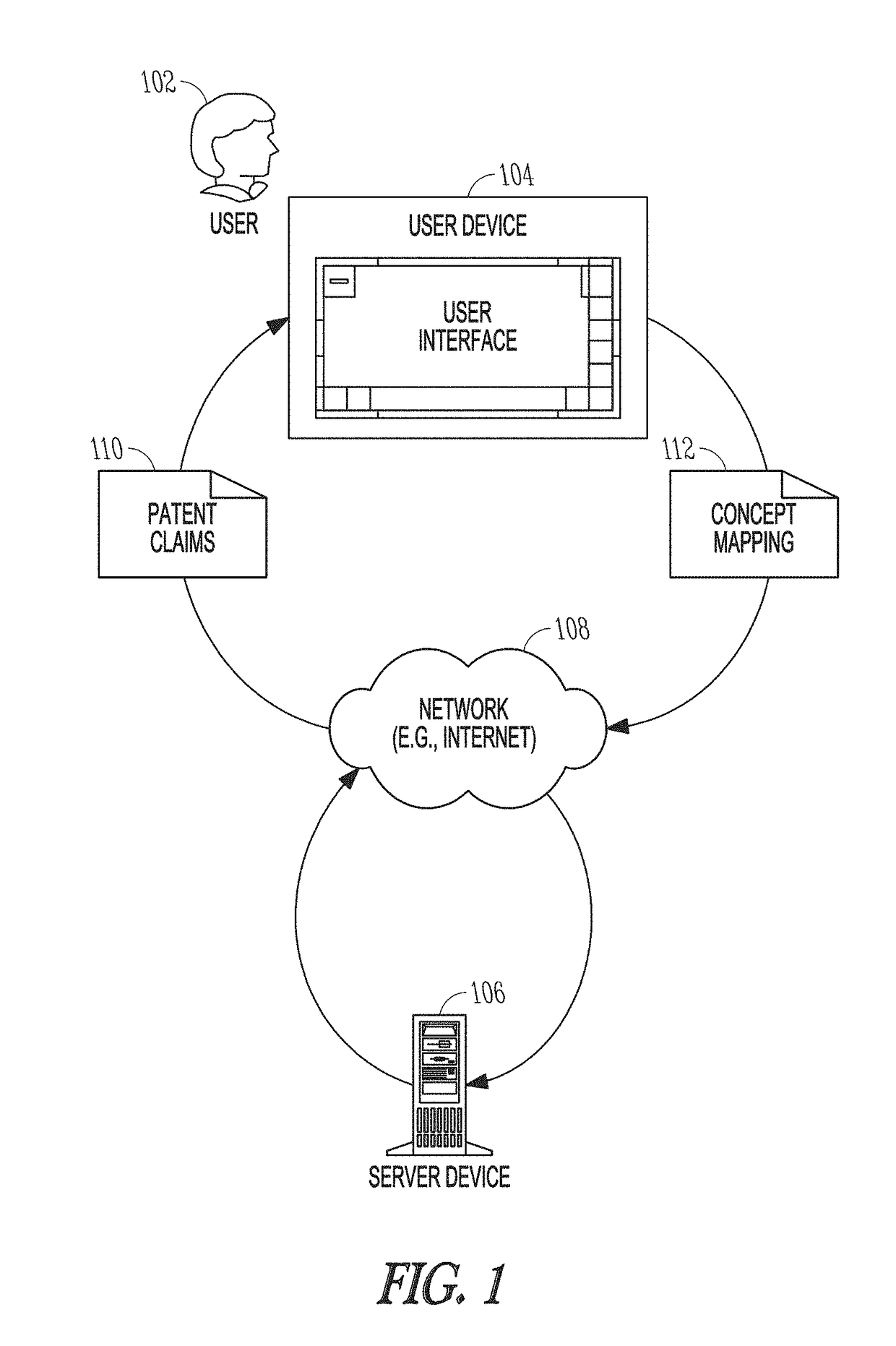

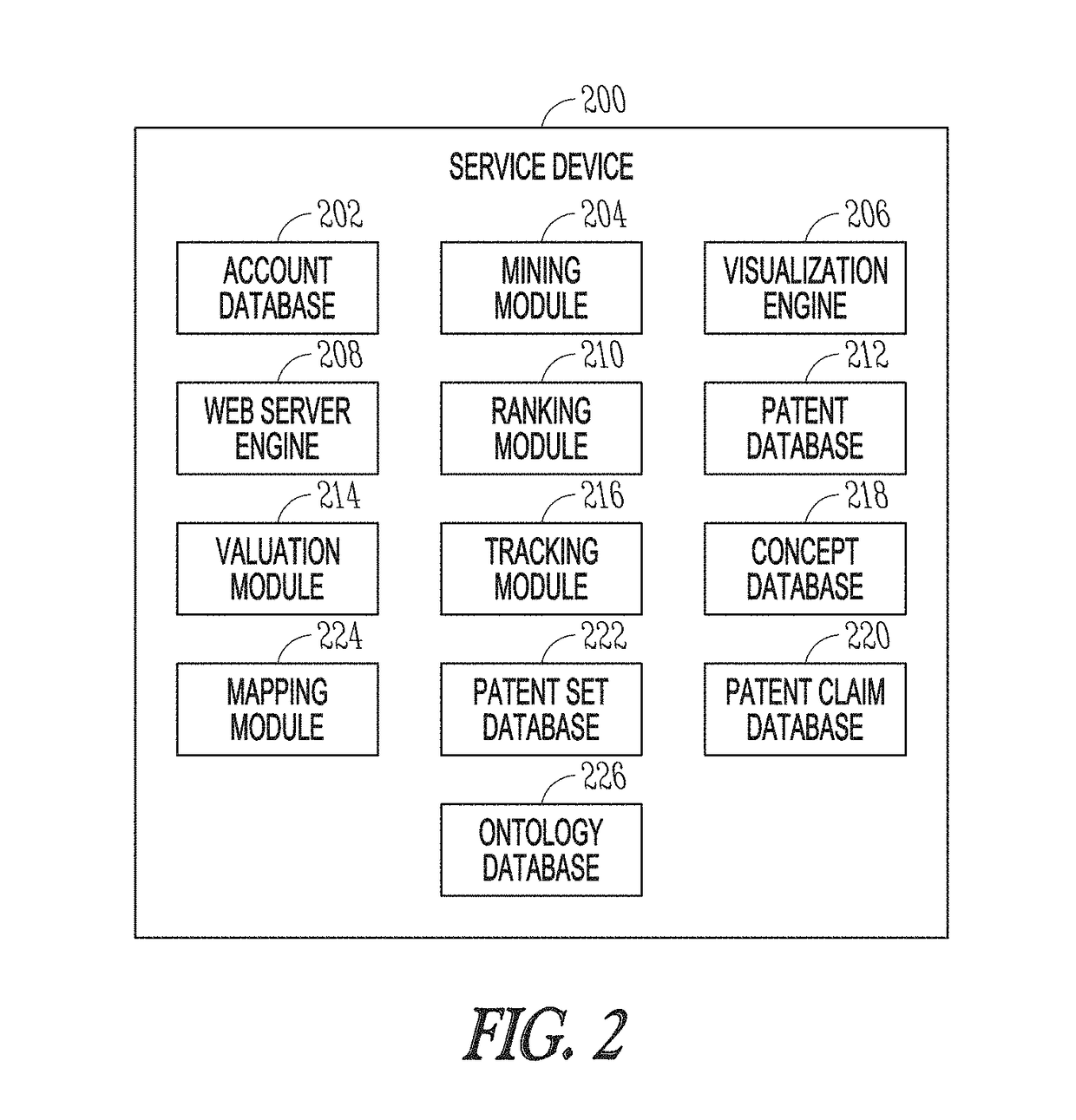

Patent mapping

InactiveUS20100131513A1Digital data information retrievalDigital data processing detailsData miningMapping system

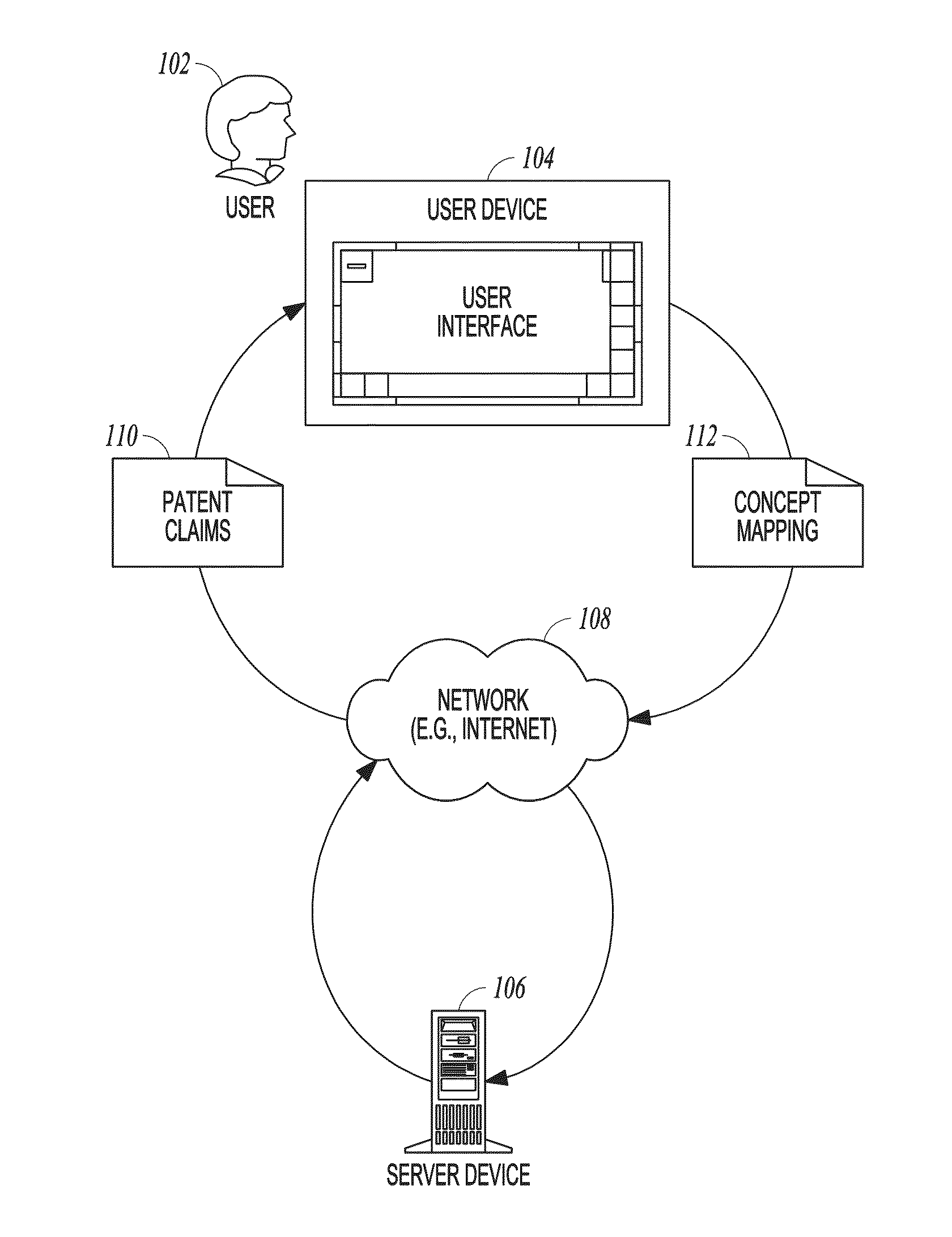

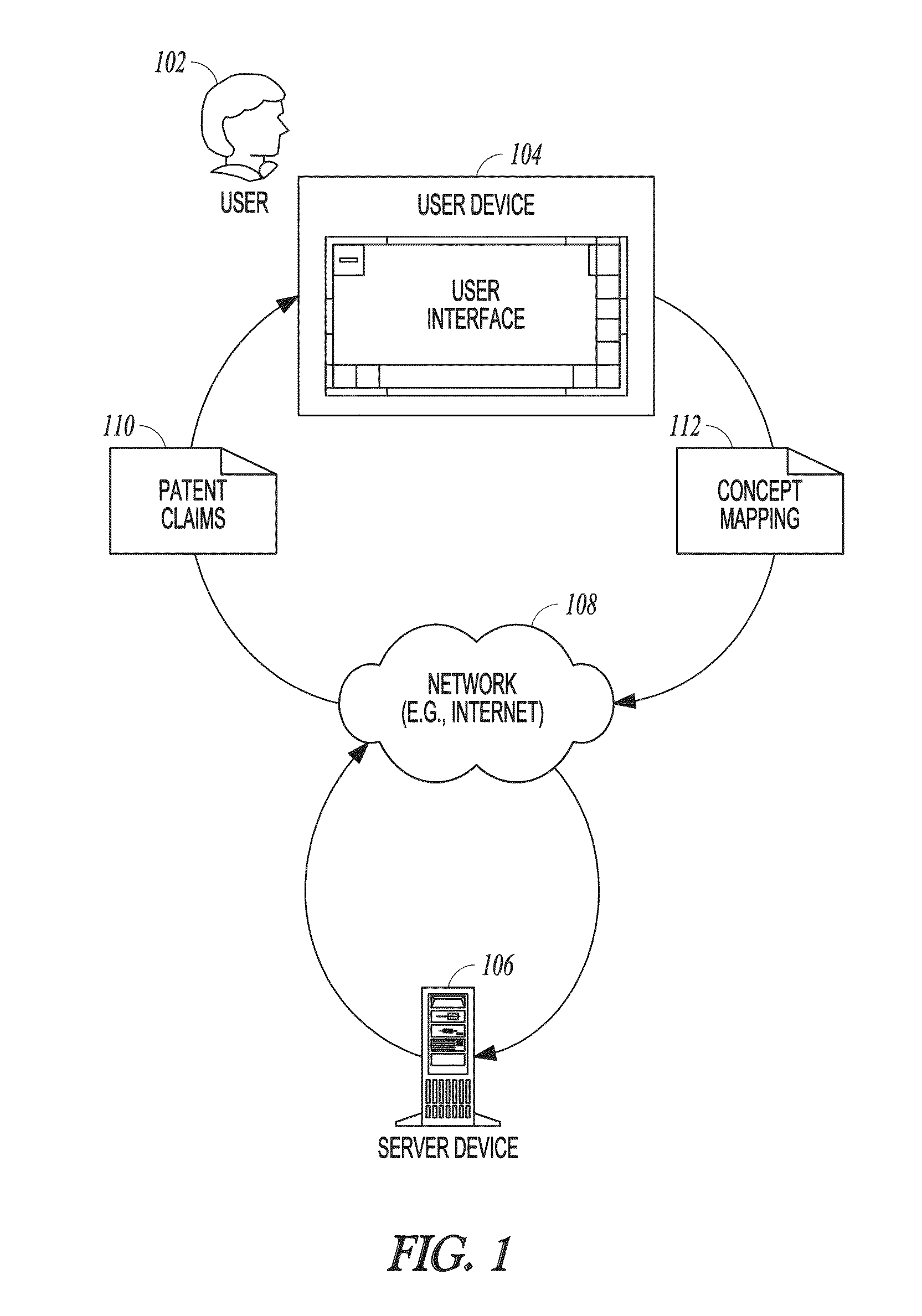

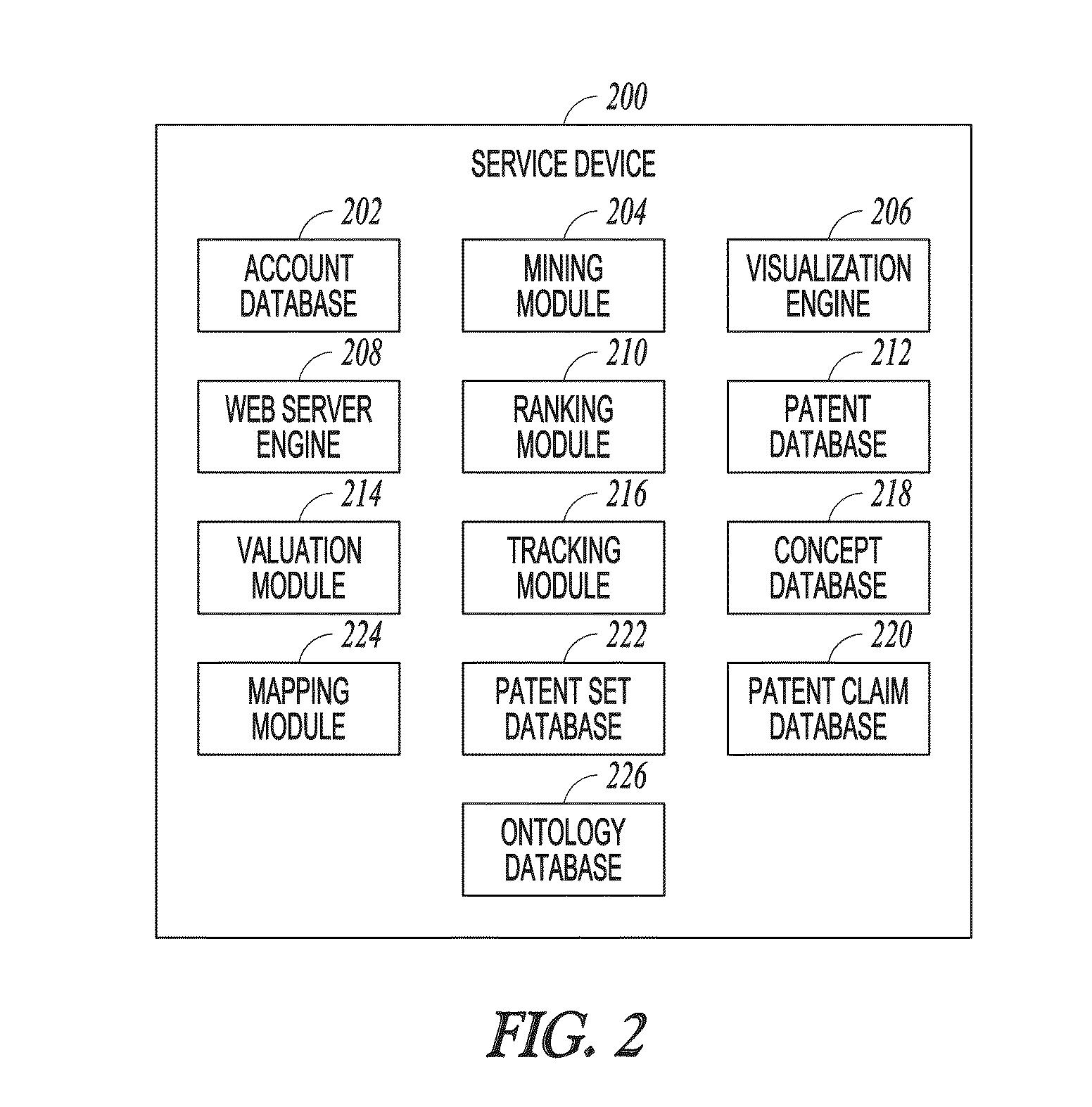

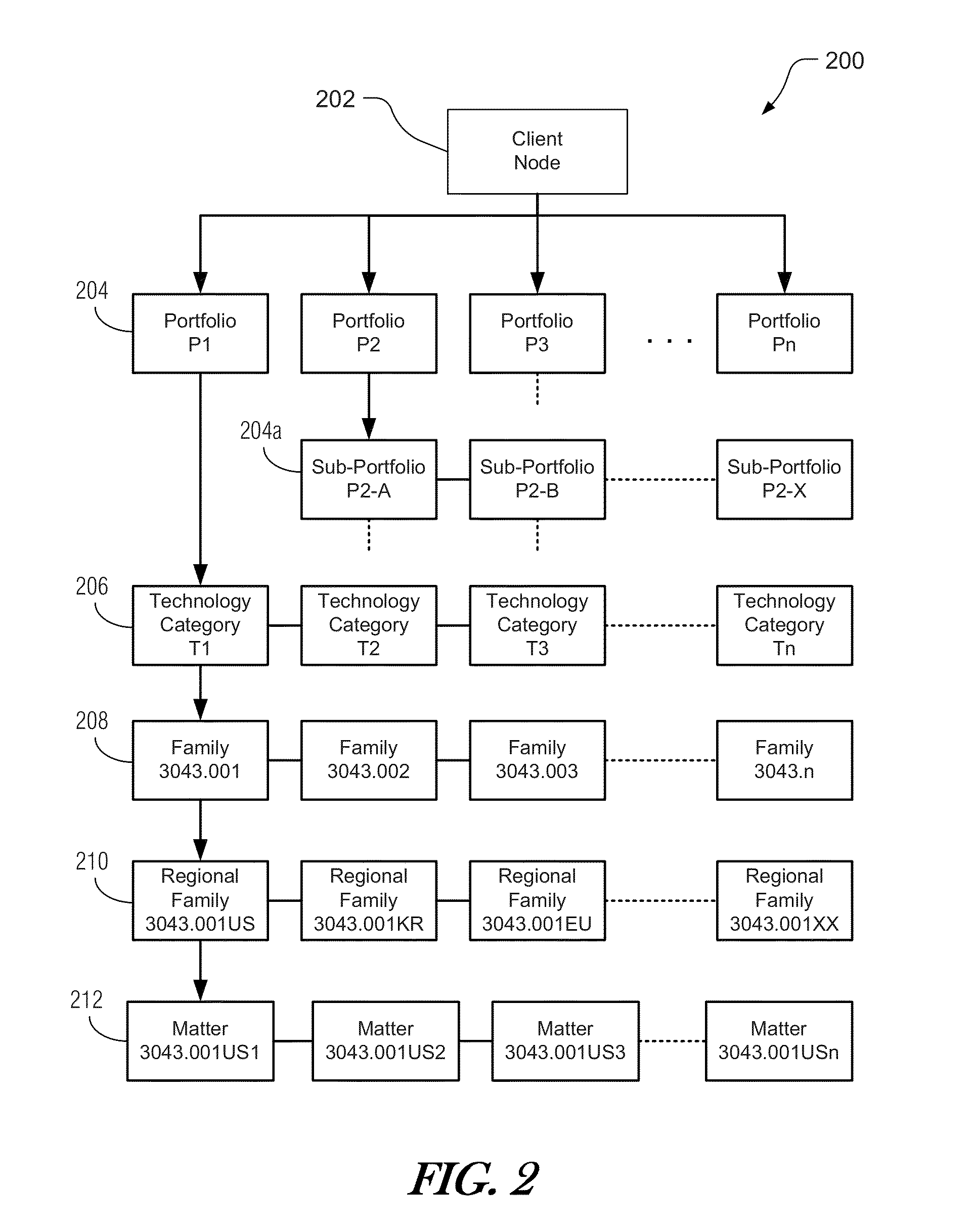

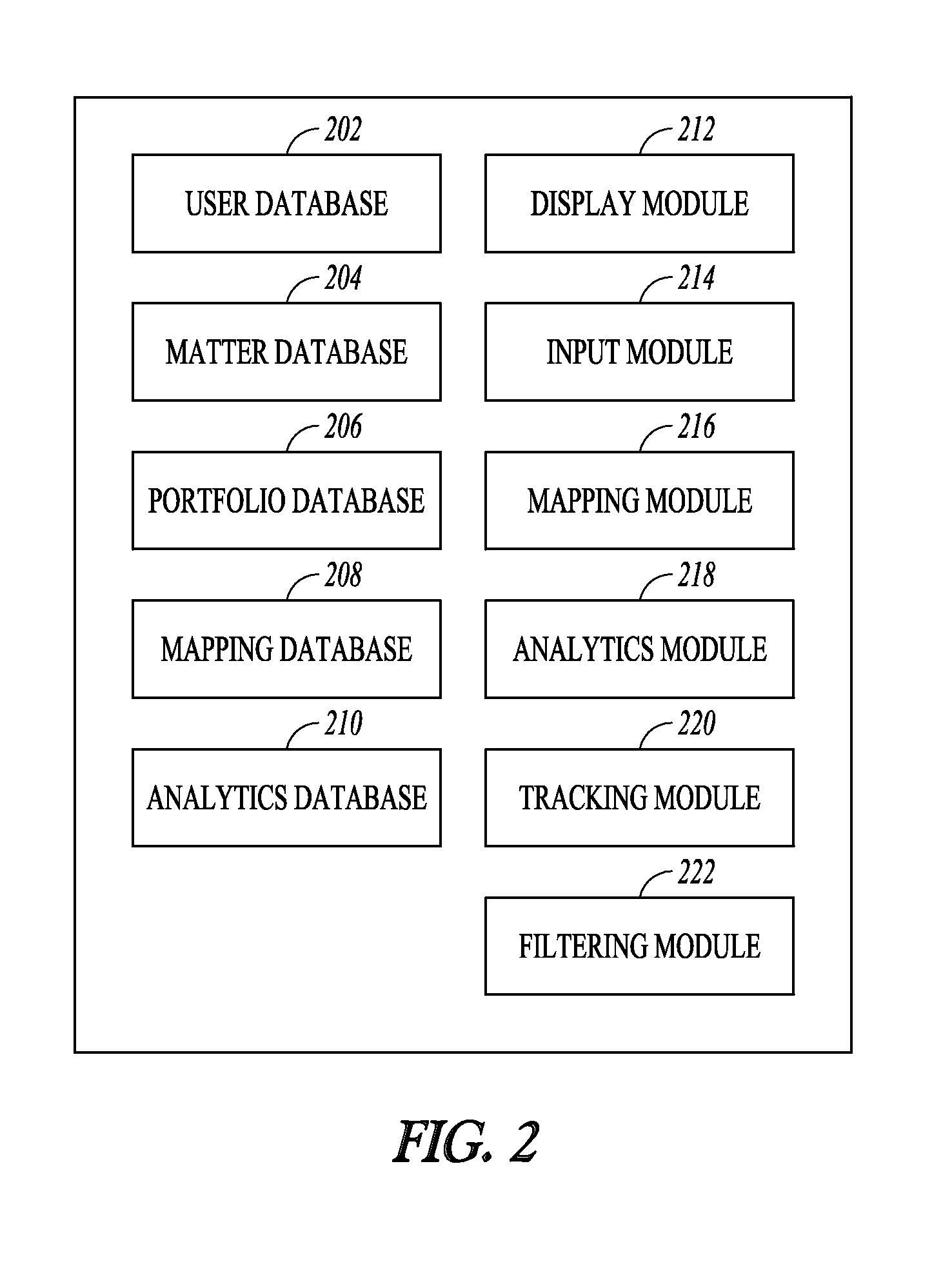

System and method permit patent mapping. A method may comprise maintaining a database of patent portfolios and a database of patents with each patent stored in the database of patents associated with one or more patent portfolios stored in the database of patent portfolios. A search query may be received associated with a first patent portfolio and the first portfolio may be searched as a function of the search query. Search results may be generate which include one or more patent claims associated with the search query. The one or more patent claims may be mapped to a patent concept.

Owner:BLACK HILLS IP HLDG

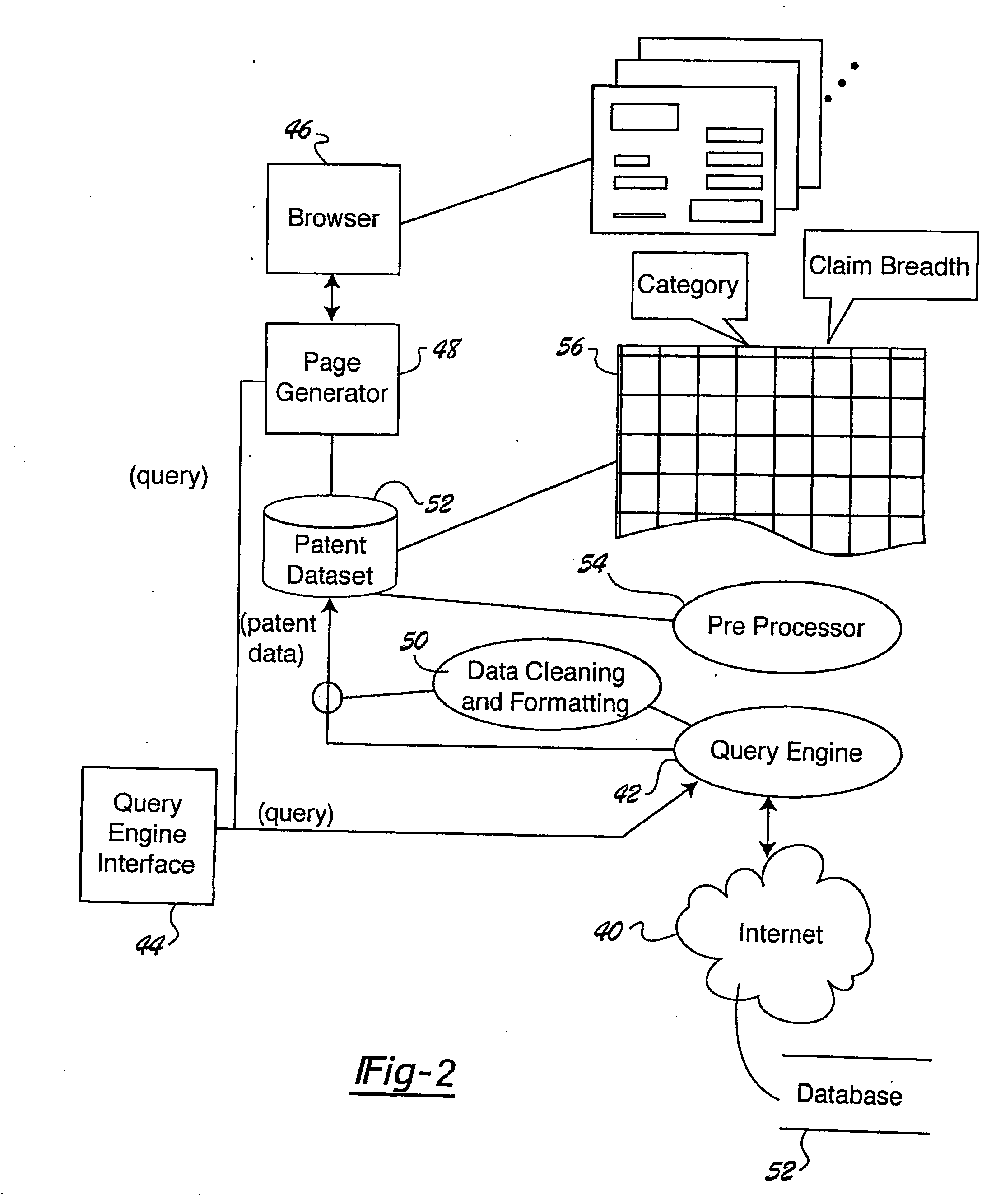

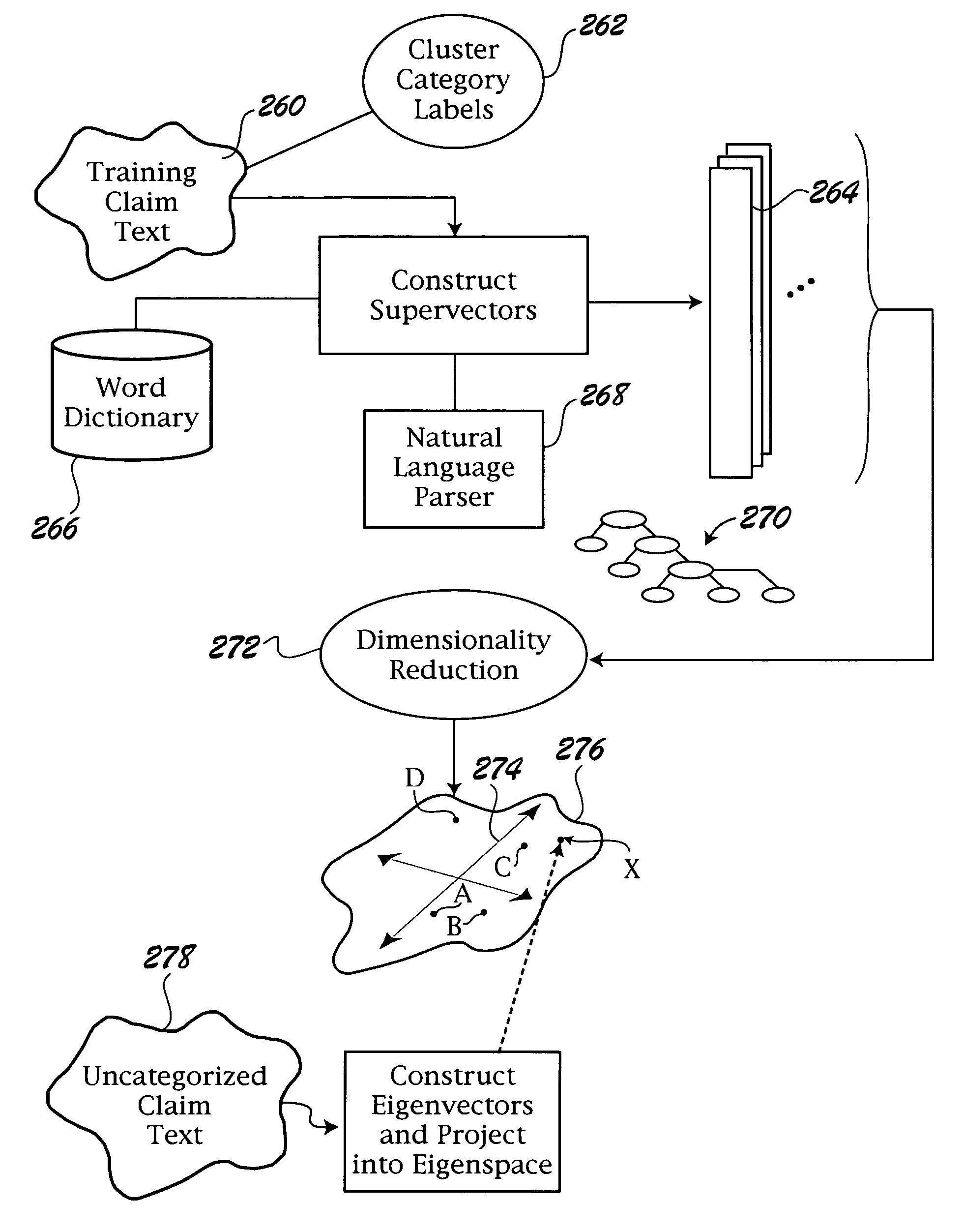

Computer-implemented patent portfolio analysis method and apparatus

A computer-implemented apparatus and method for performing patent portfolio analysis. The patent portfolio analysis apparatus and method clusters a group of patents based upon one or more techniques. The clustering techniques include linguistic clustering techniques (e.g., eigenvector analysis), claim meaning, and patent classification techniques. Different aspects of the clusters are analyzed, including financial, claim breadth, and assignee patent comparisons. Moreover, patents and / or their clusters are linked to the Internet in order to determine what products might be covered by the claims of the patents or whether materials on the Internet might render patent claims invalid.

Owner:ONTOLOGICS INC

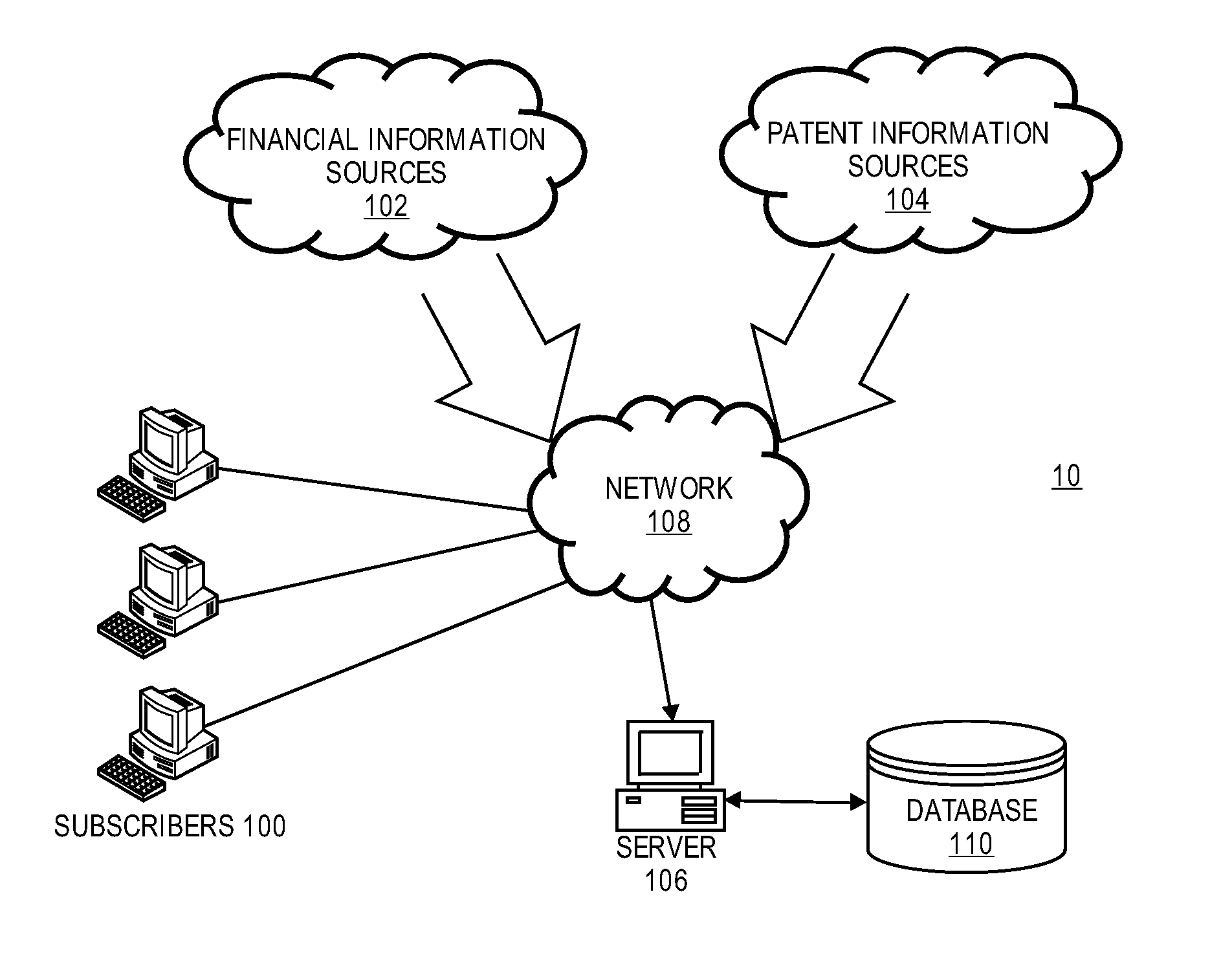

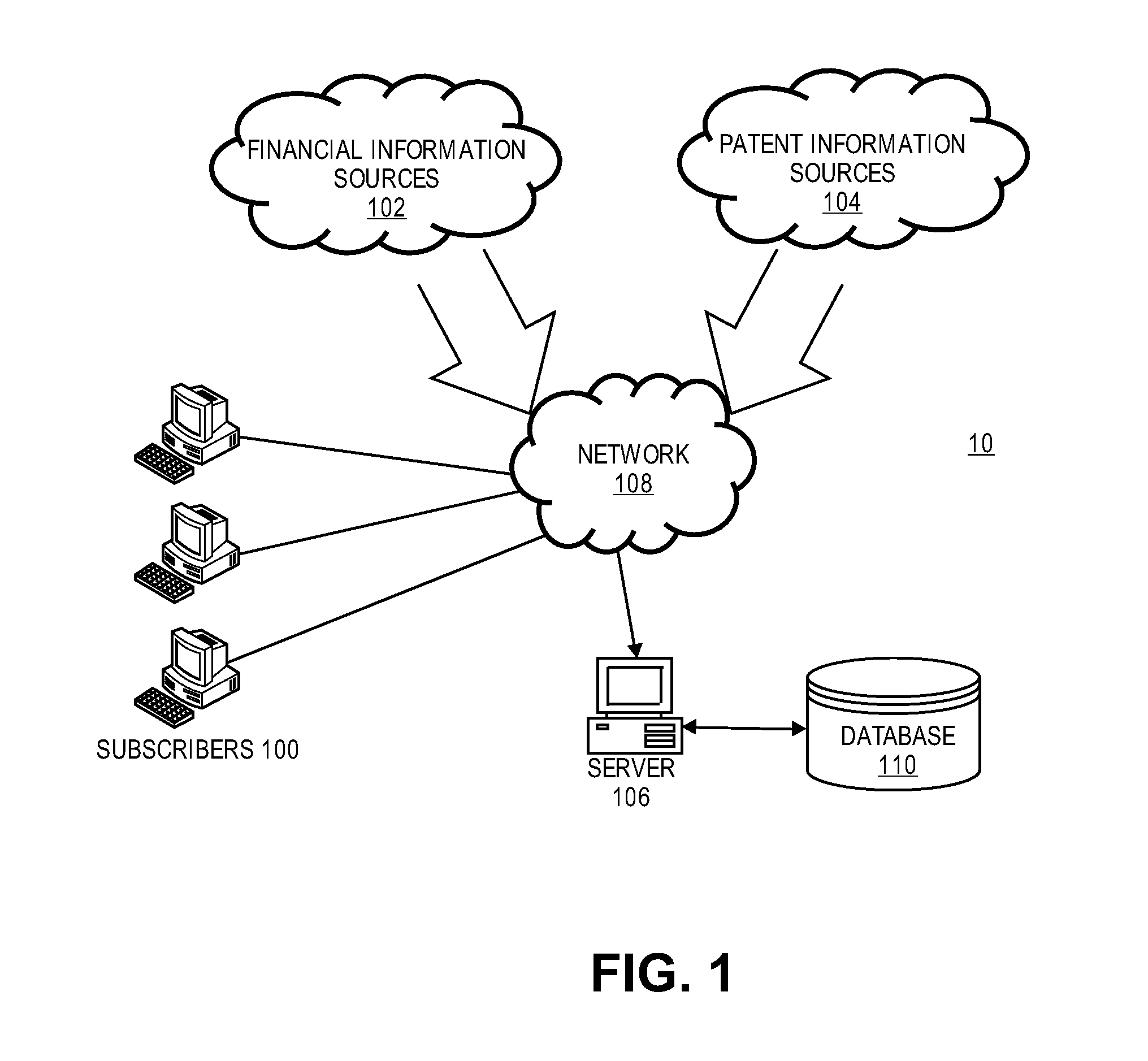

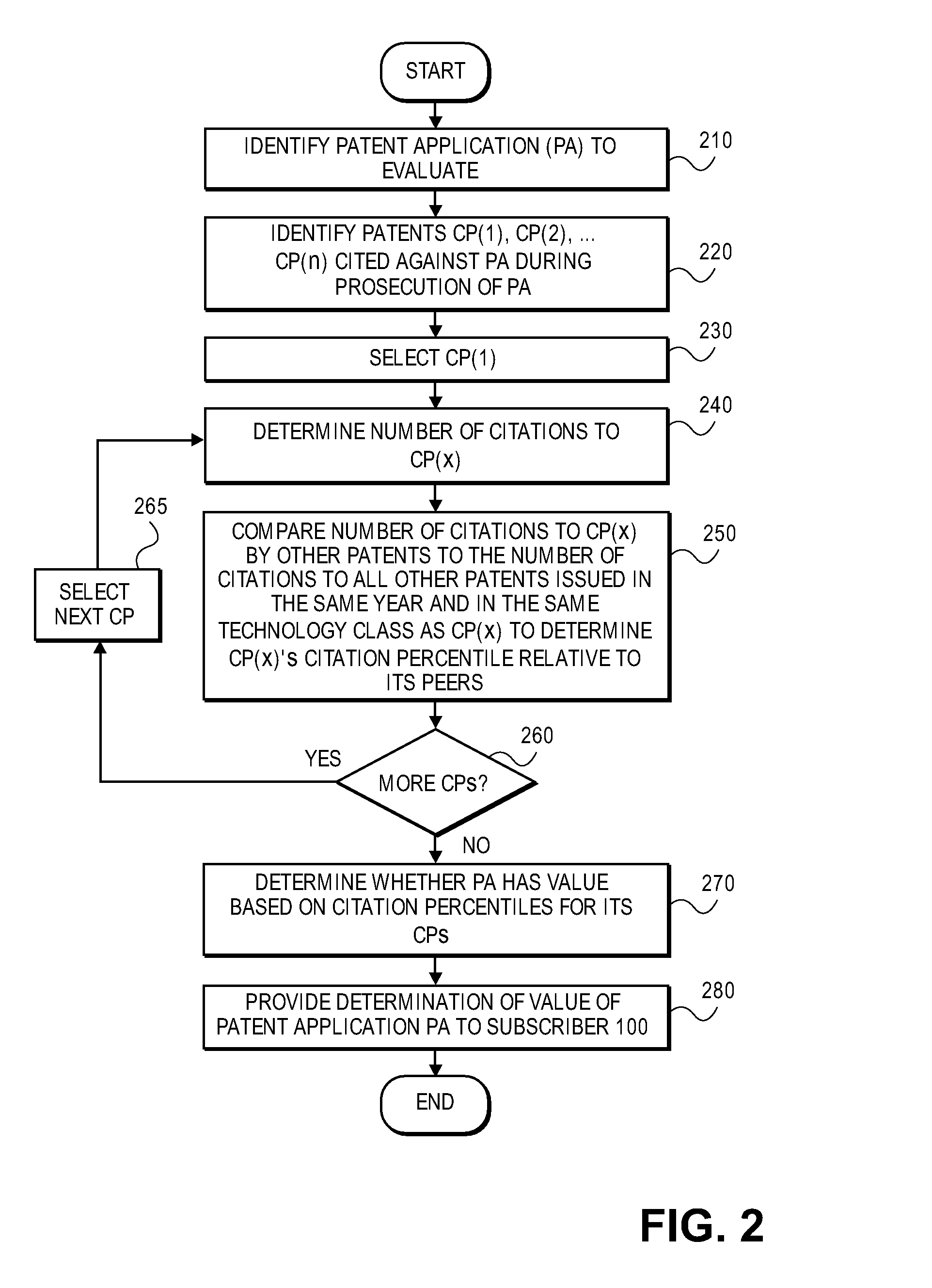

Methods and Systems for Analyzing Patent Applications to Identify Undervalued Stocks

The present invention relates to predicting the value of a published patent application prior to its issuance as a patent. Once a patent application publishes, as most U.S. applications do eighteen months after filing, one can identify the patents cited against the patent application during its prosecution. Such patents may be cited by the applicant in an Information Disclosure Statement (IDS) and / or by the Examiner assigned by the Government to examine the patentability of the application. In some embodiments, the cited patents are evaluated by comparing how frequently they are cited relative to other patents that issued in the same year and in the same technology class. If the cited patents are frequently cited relative to their peers, then the subject patent application likely covers significant technology and has value. The present invention may have several implementations. For example, the present invention may simply be embodied as a service that provides metrics for or reports on the value of various patent applications. In other embodiments, the method for evaluating the value of a single patent application is extended to each of the patent applications in a patent portfolio so as to render judgment on the value of the entire application portfolio. In turn, one can use the value of all or part of the patent-application portfolio to help identify stocks of undervalued companies.

Owner:AVRUNIN ADAM

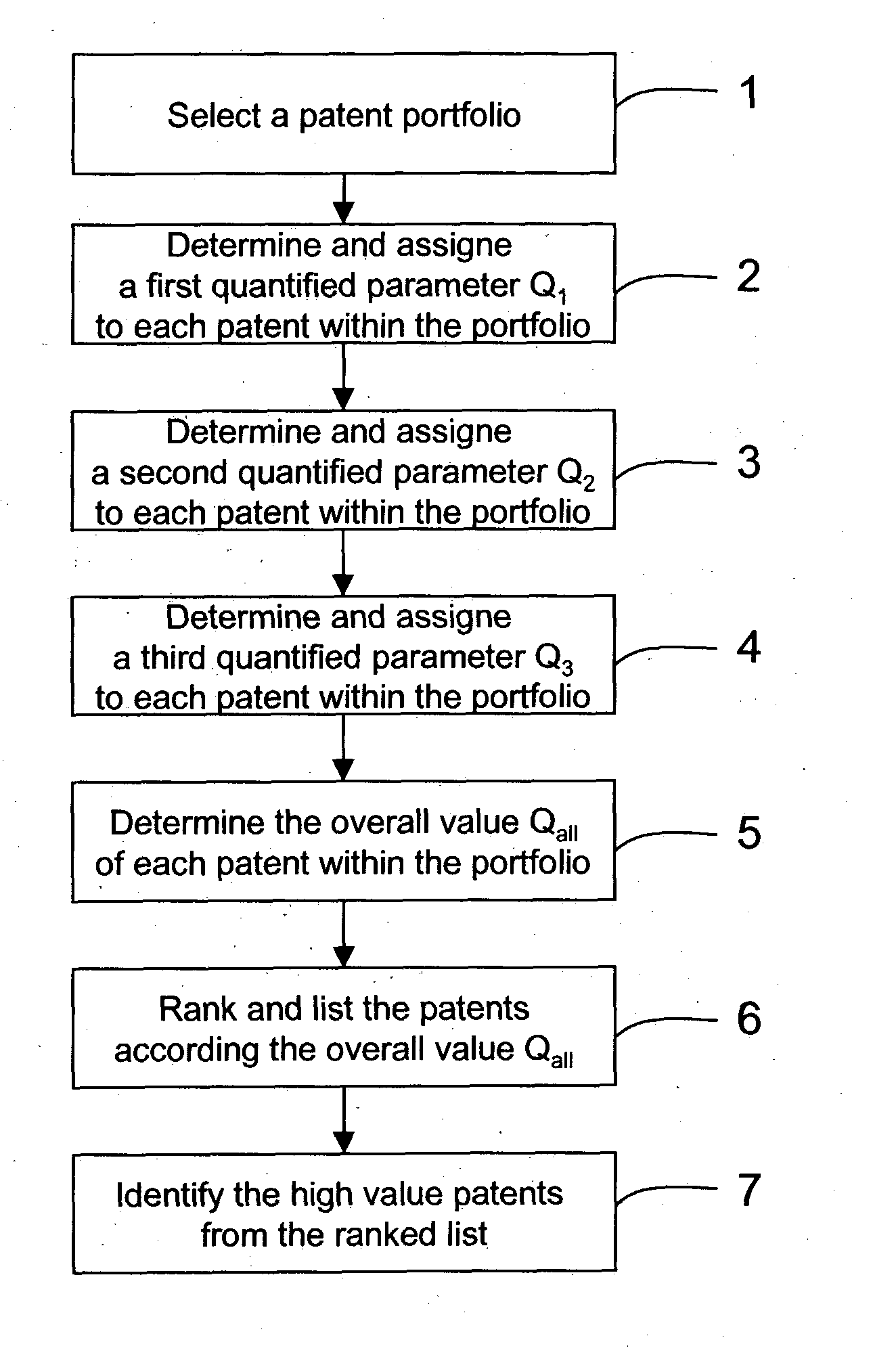

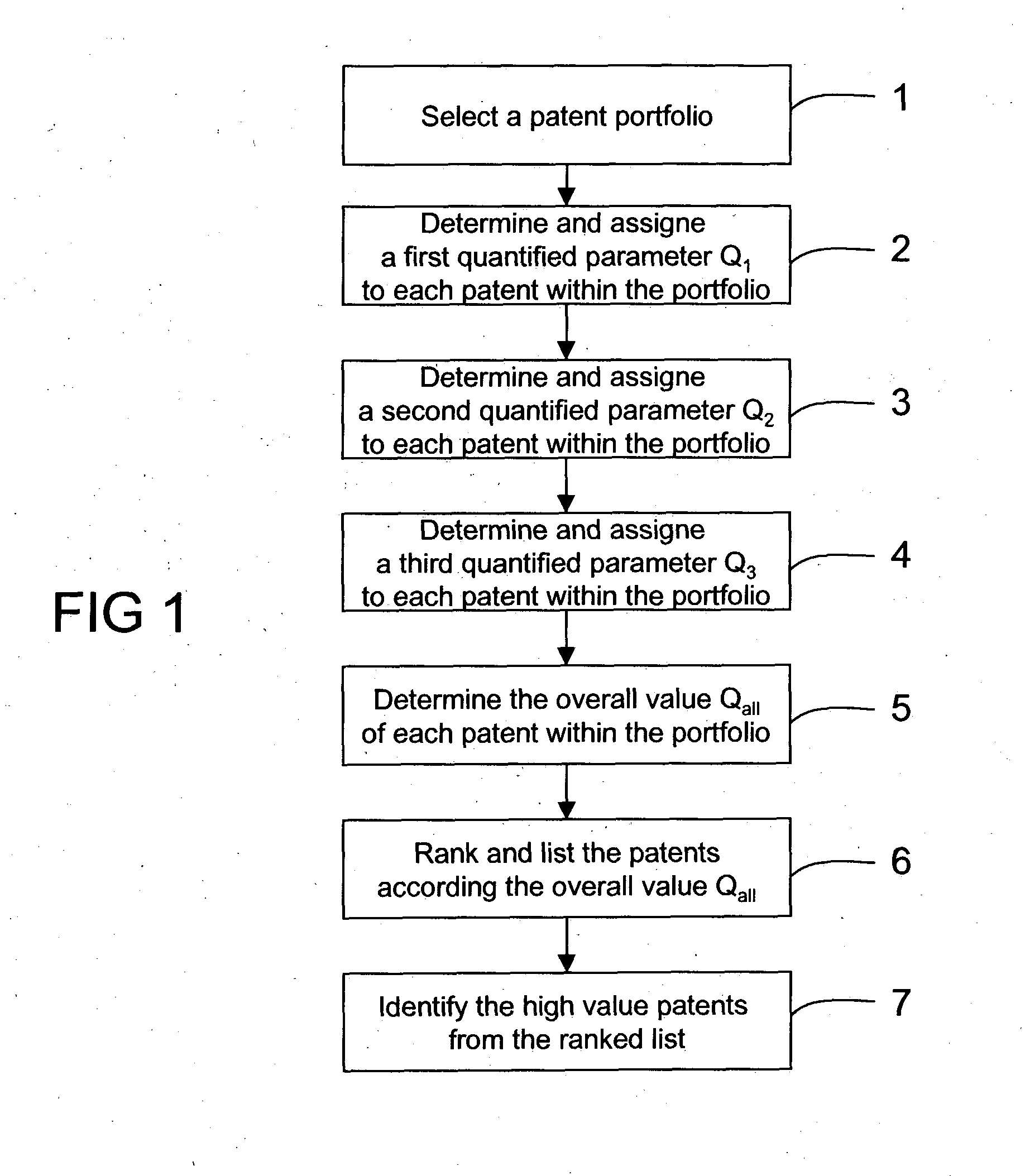

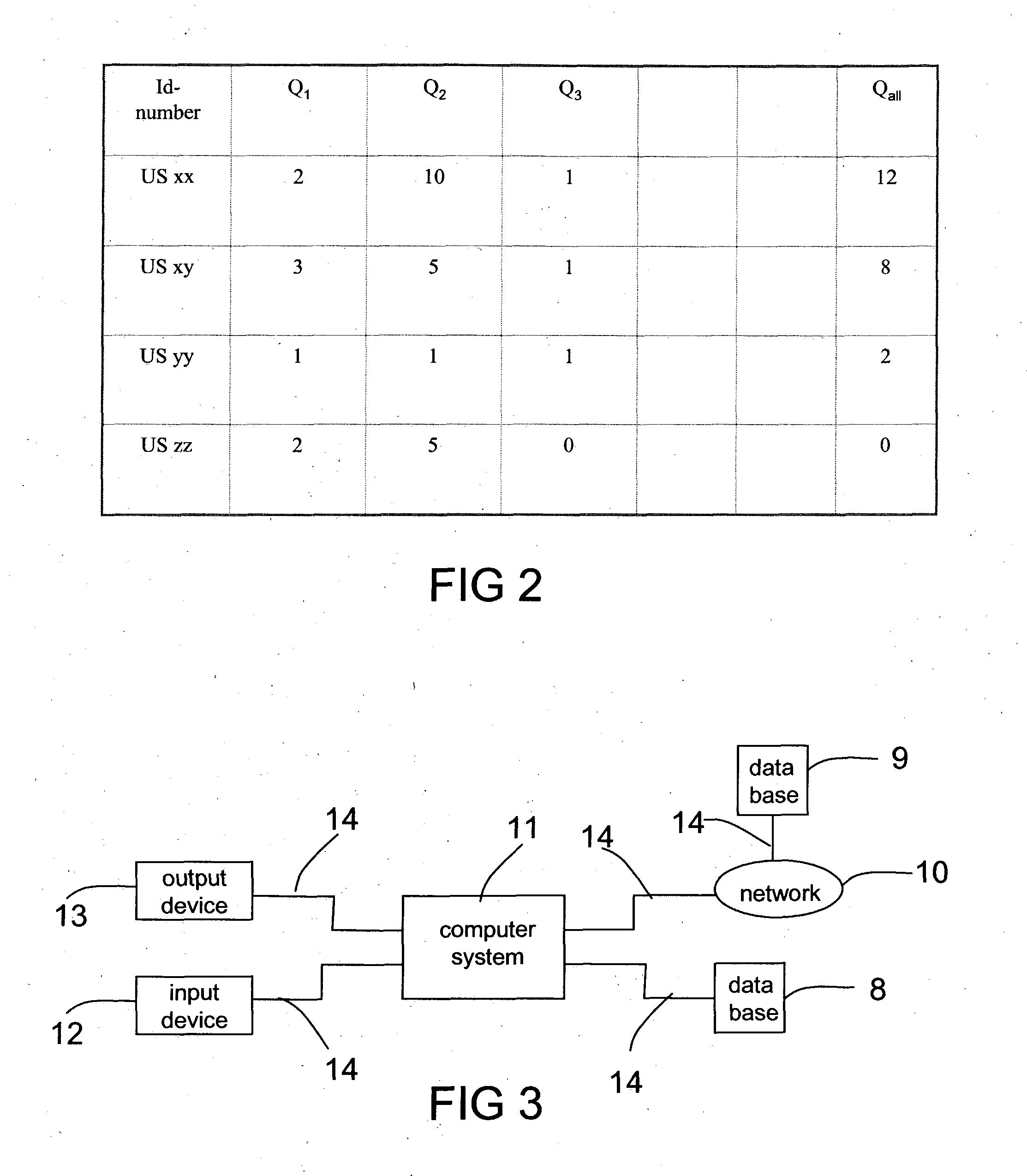

Method of identifying high value patents within a patent porfolio

InactiveUS20050010515A1Fast and simple and accurate methodFinanceOffice automationRankingEngineering

The present invention provides a fast, simple and accurate method of identifying high value patents from within a patent portfolio, furthermore the invention can also be used to identify potential parties which could be interested in a patent, e.g. for buying it. To identify high value patents quantified parameters will be determined and assigned to the patents from within a patent portfolio. After the assessment of the overall quantified value of each patent and the ranking of the patents in respect of the overall value it is easy to identify high value patents.

Owner:SIEMENS AG

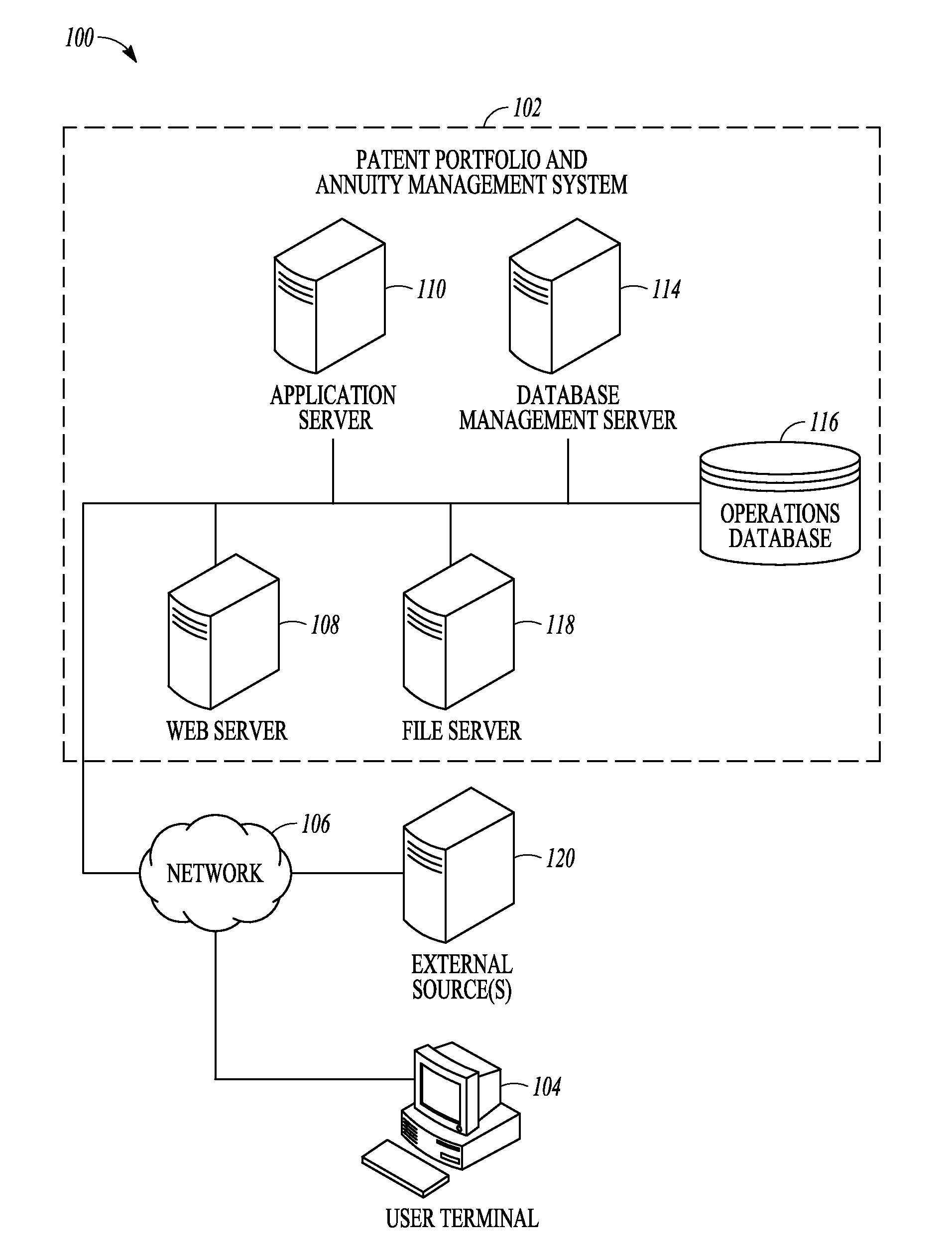

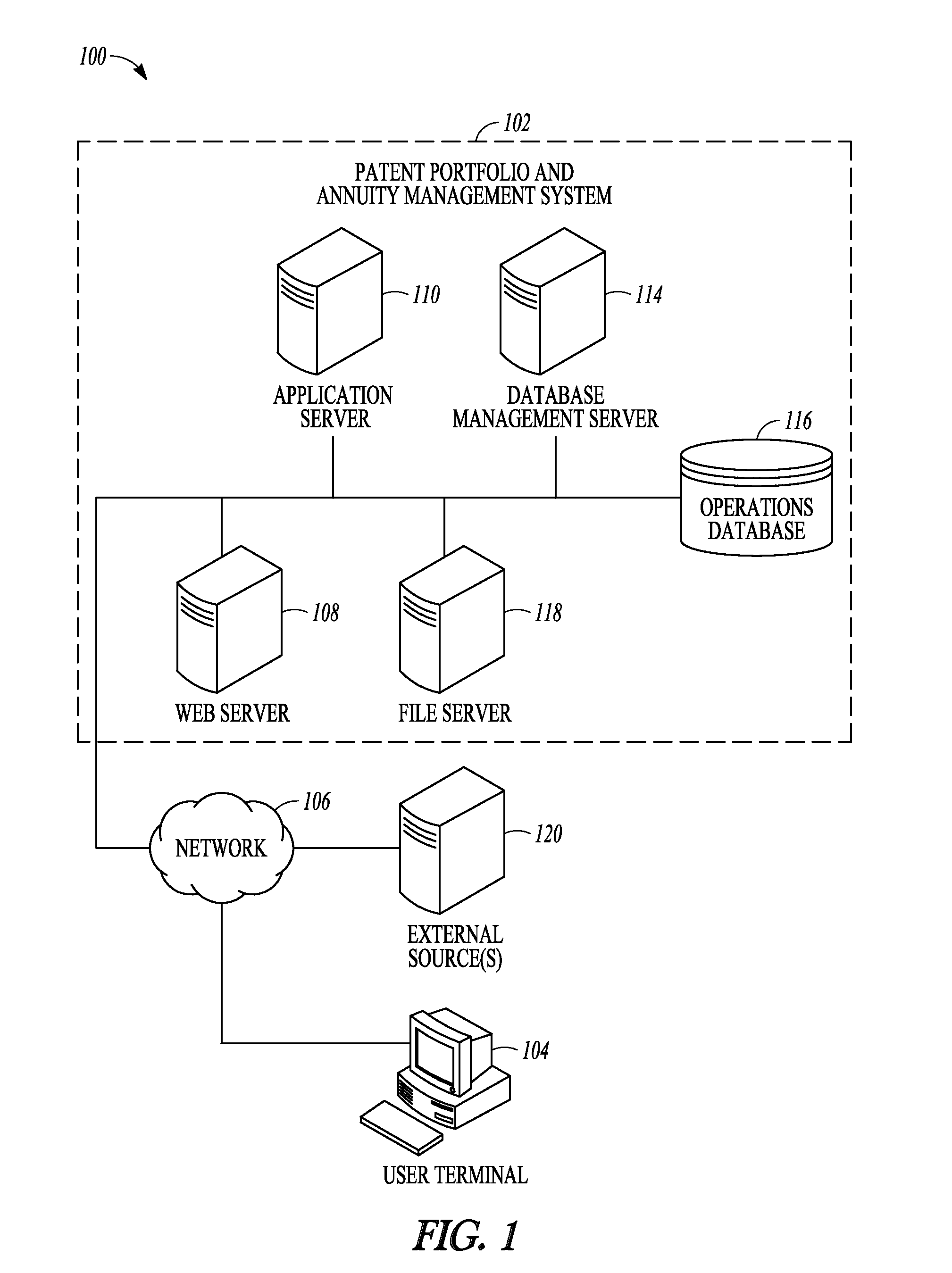

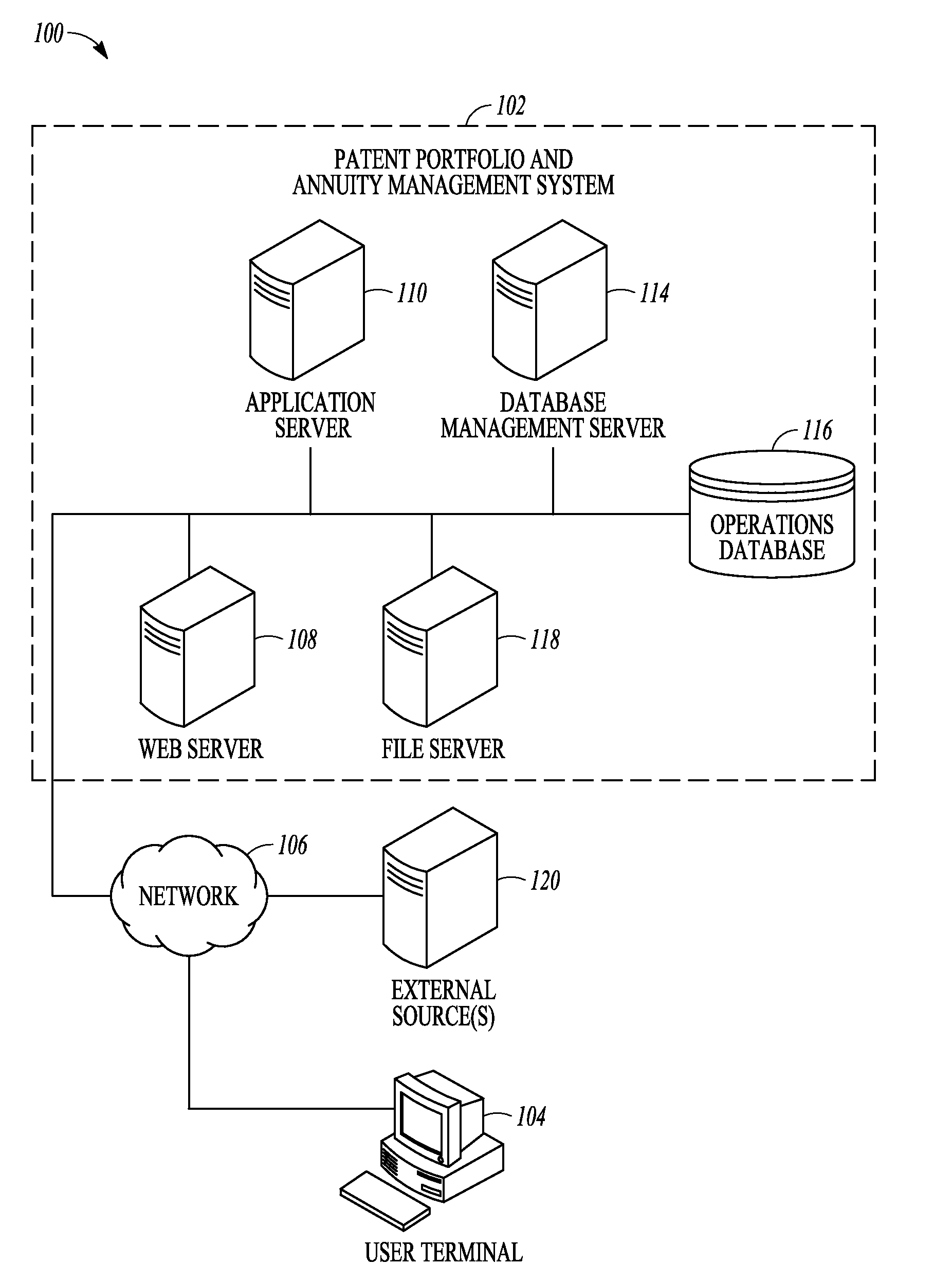

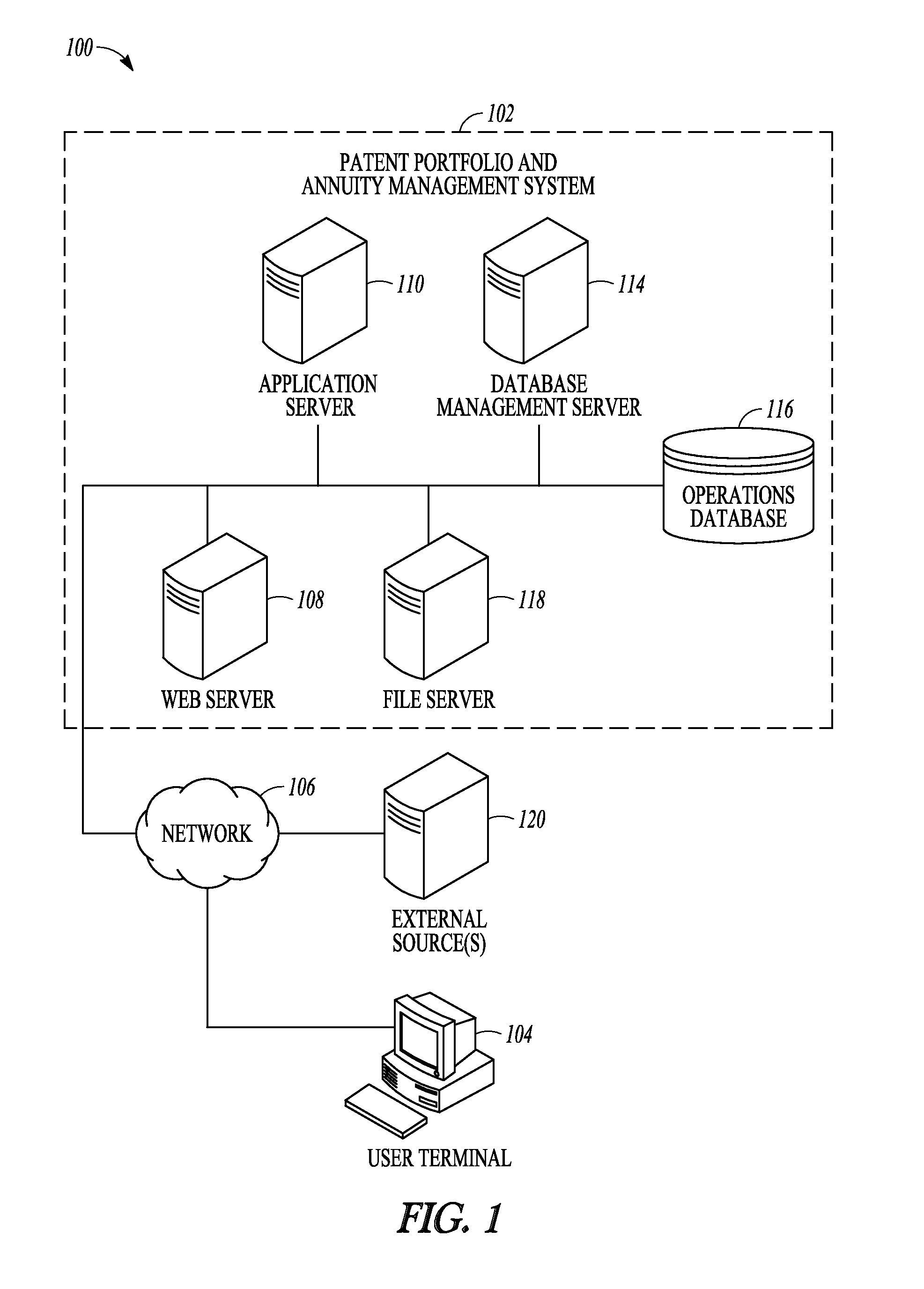

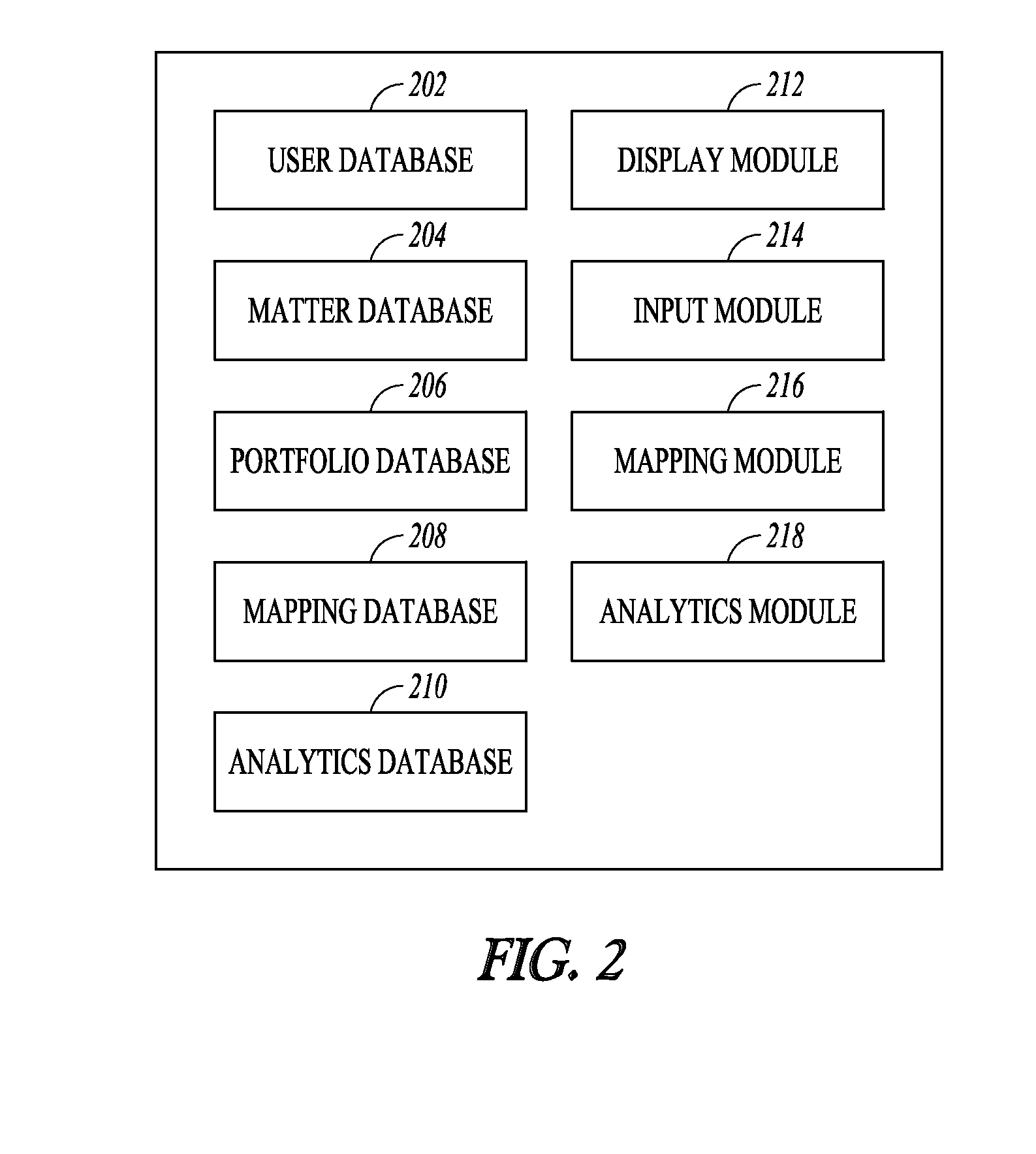

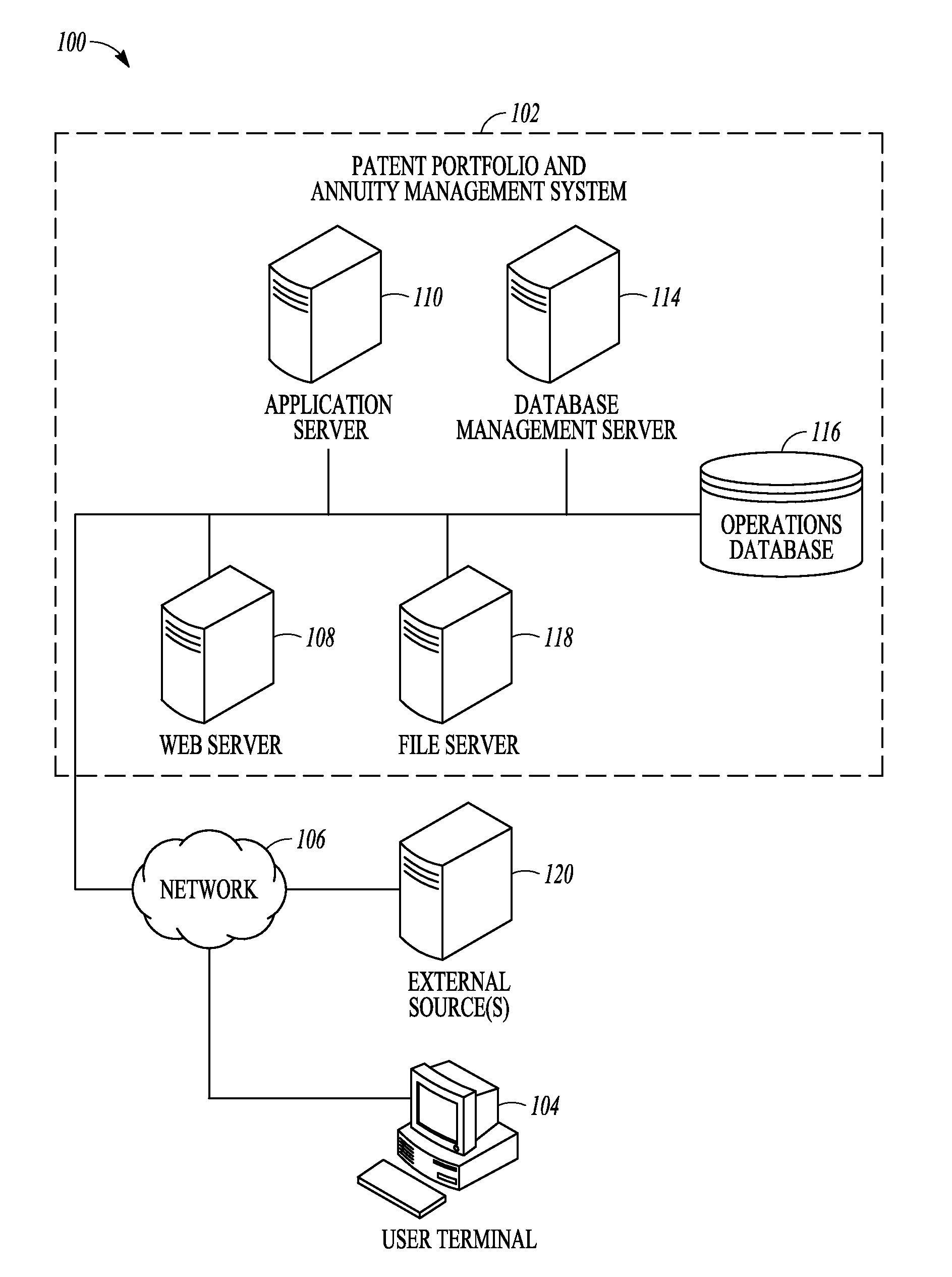

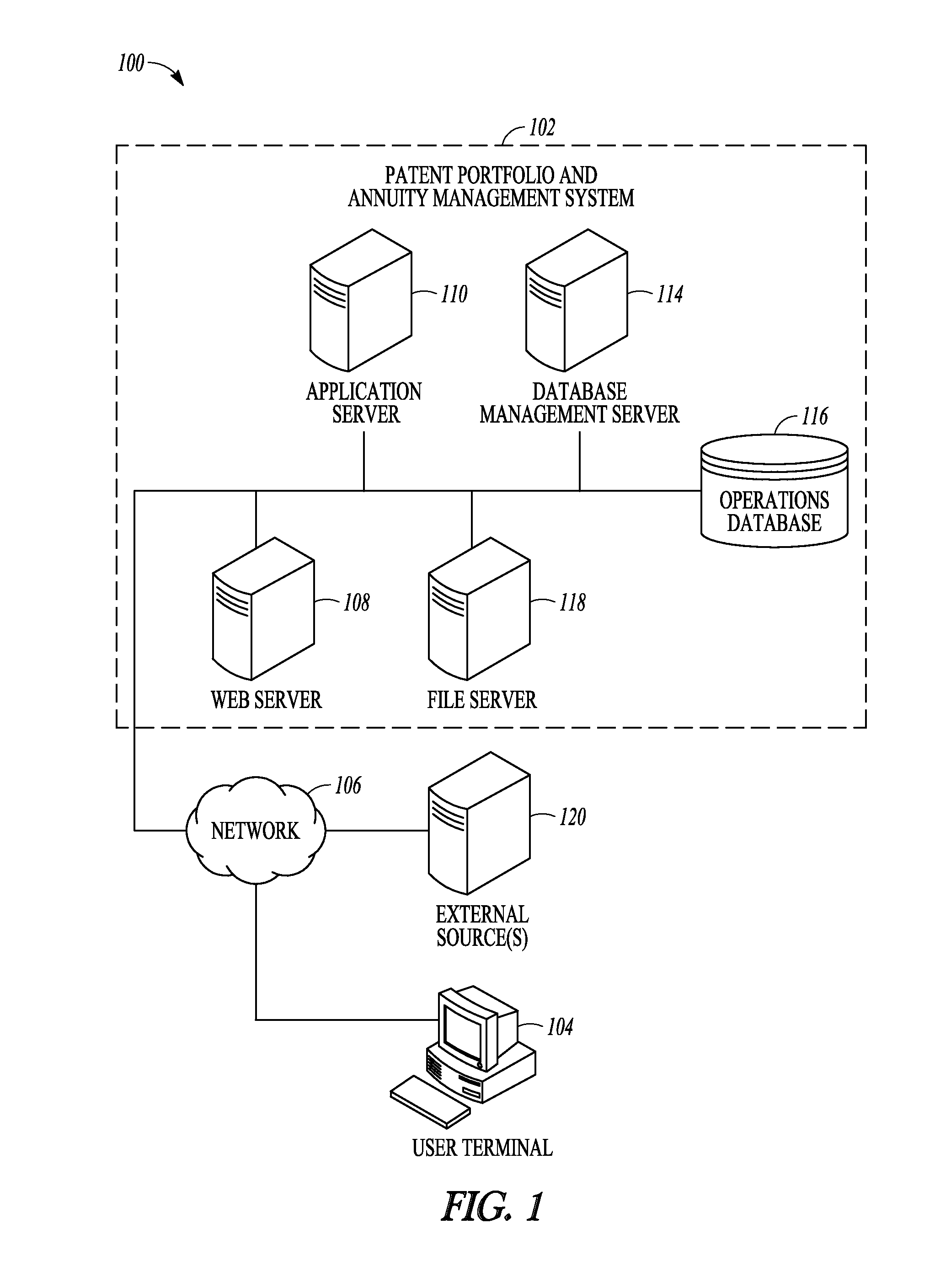

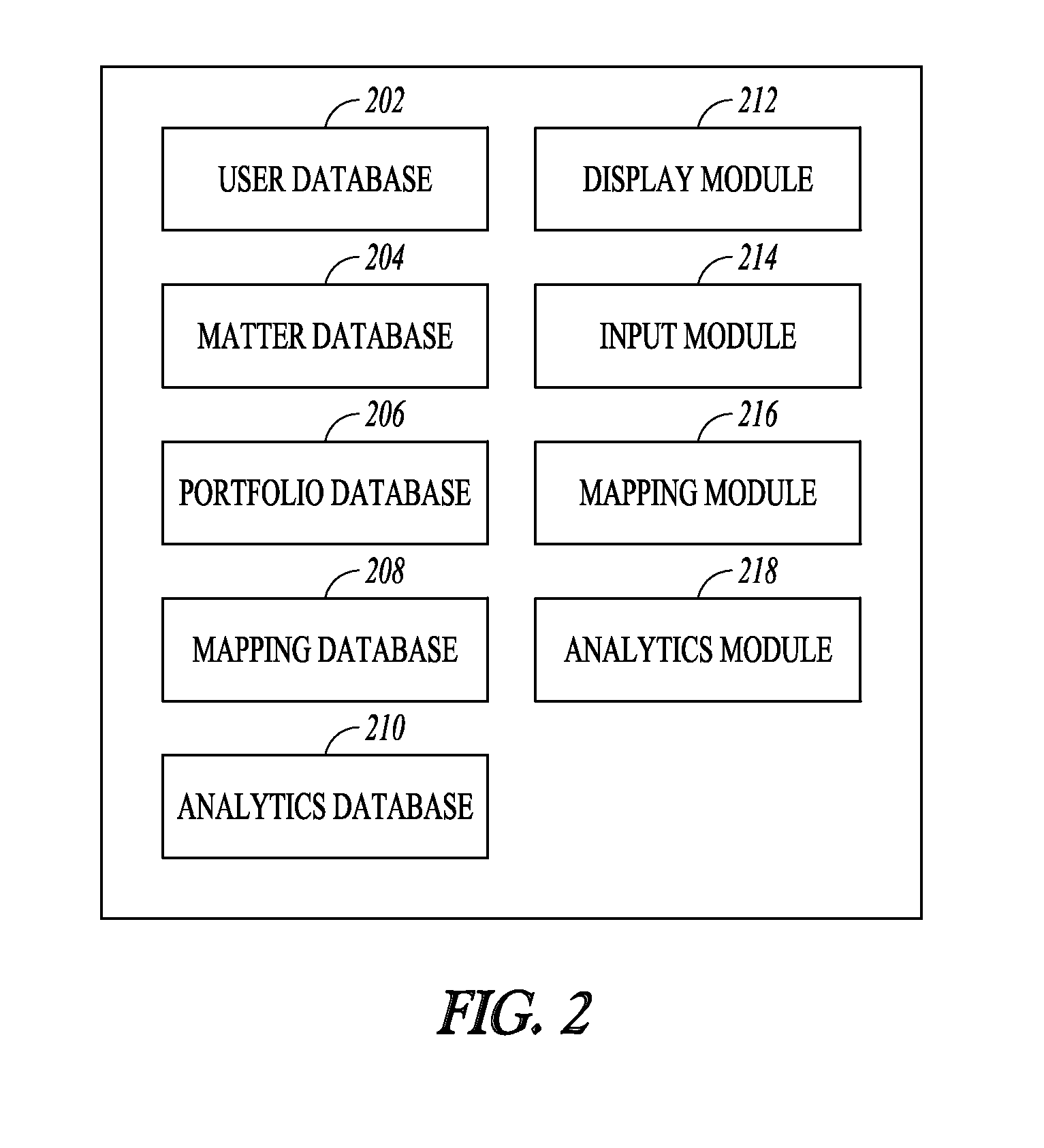

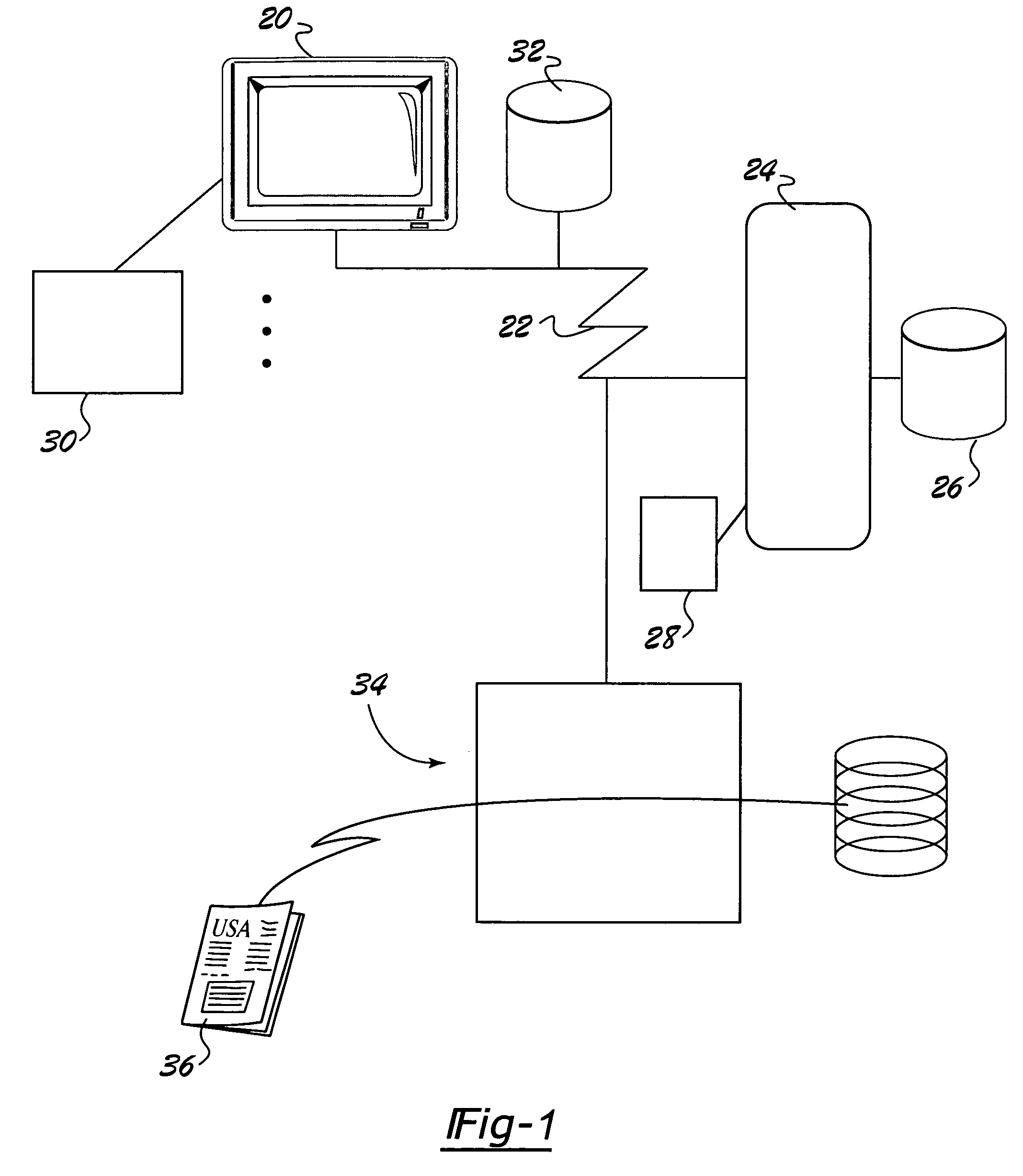

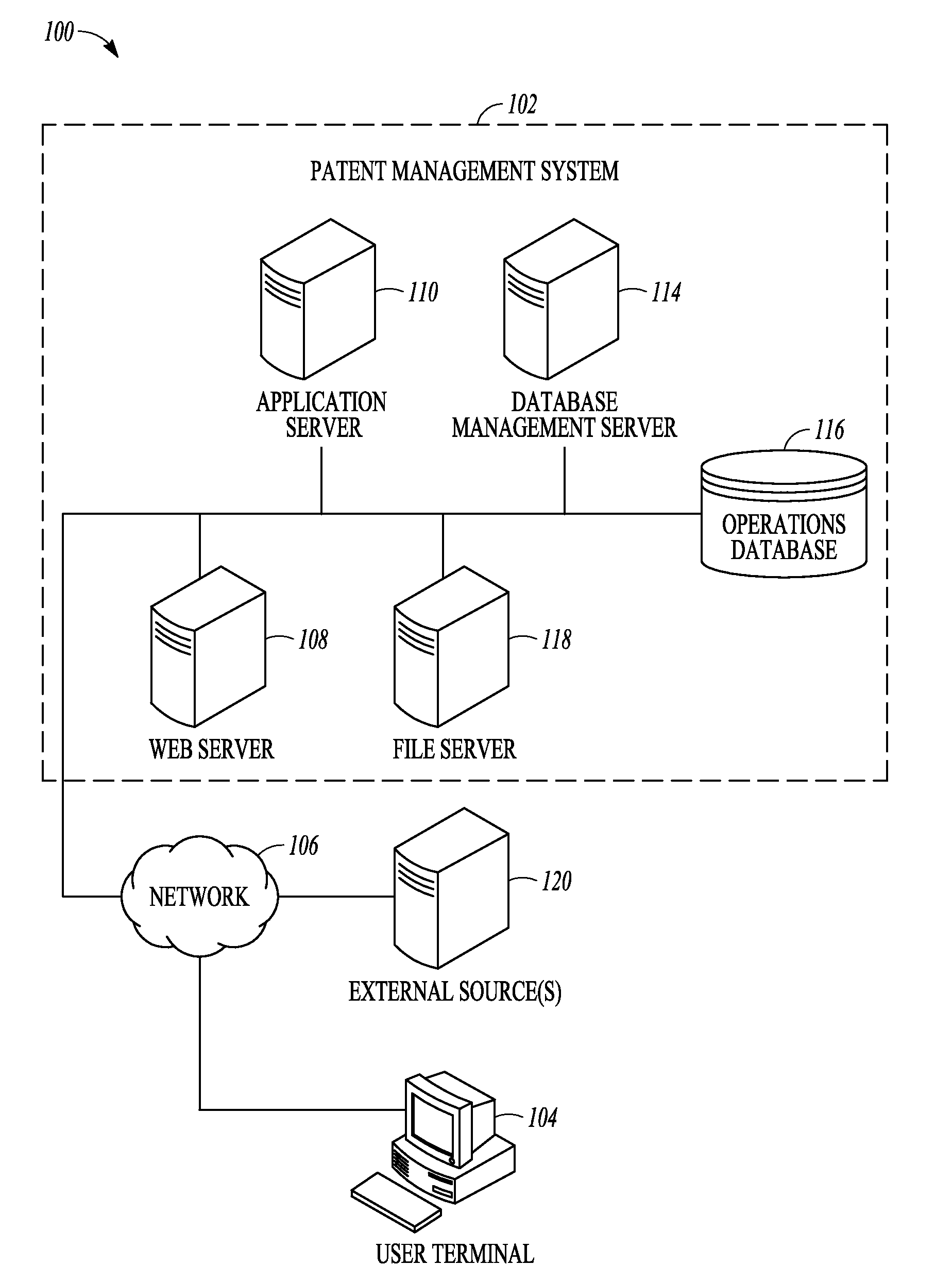

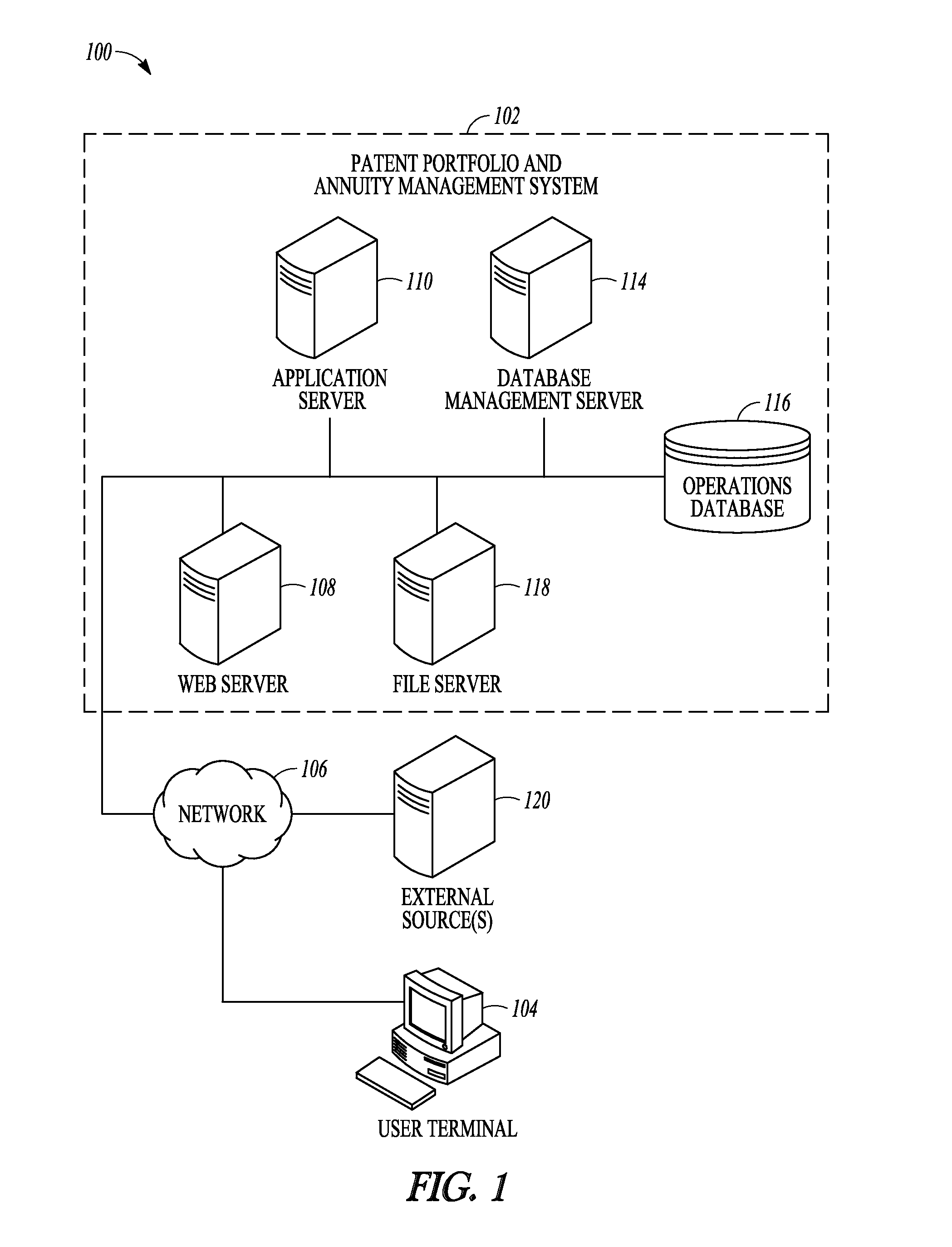

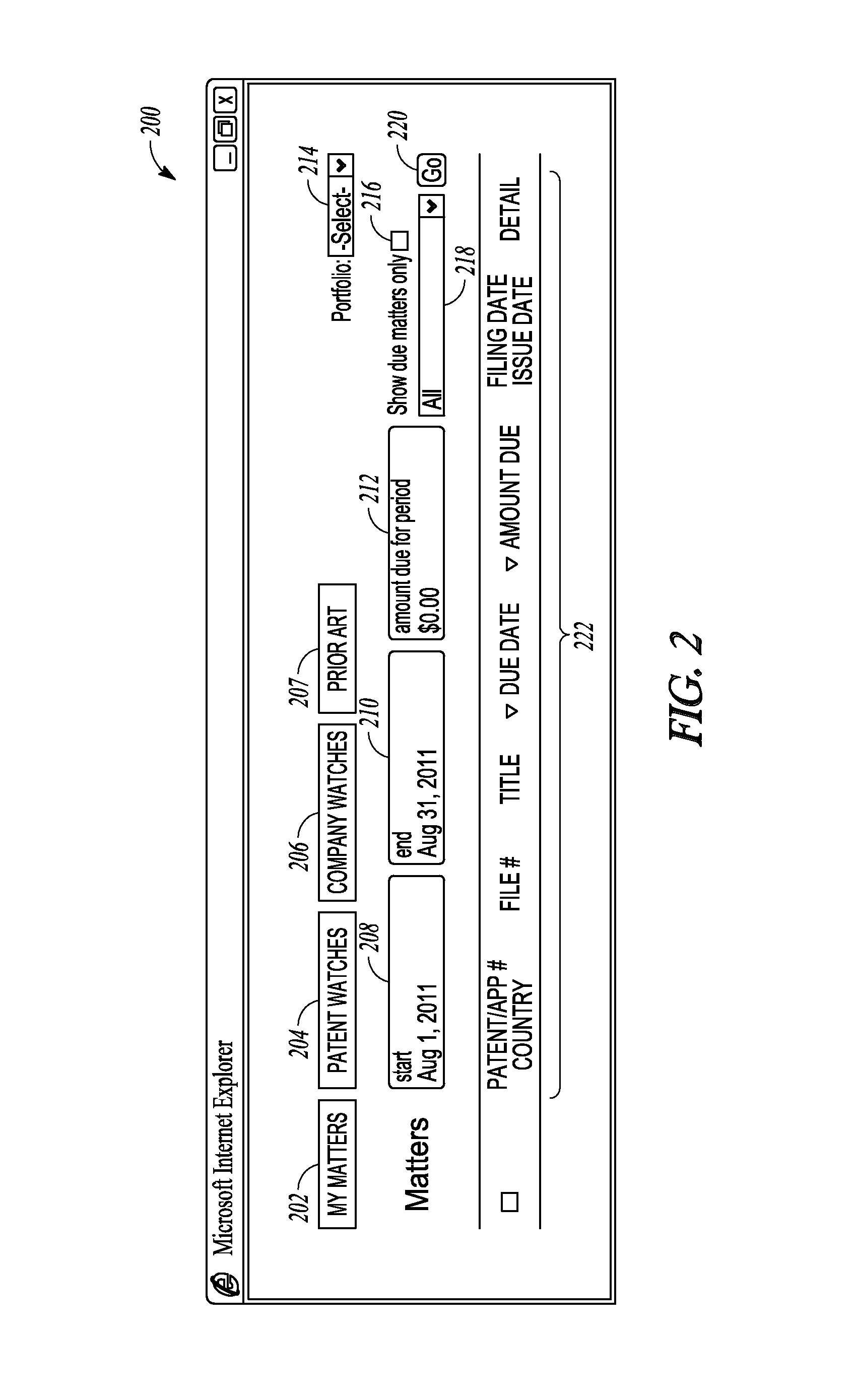

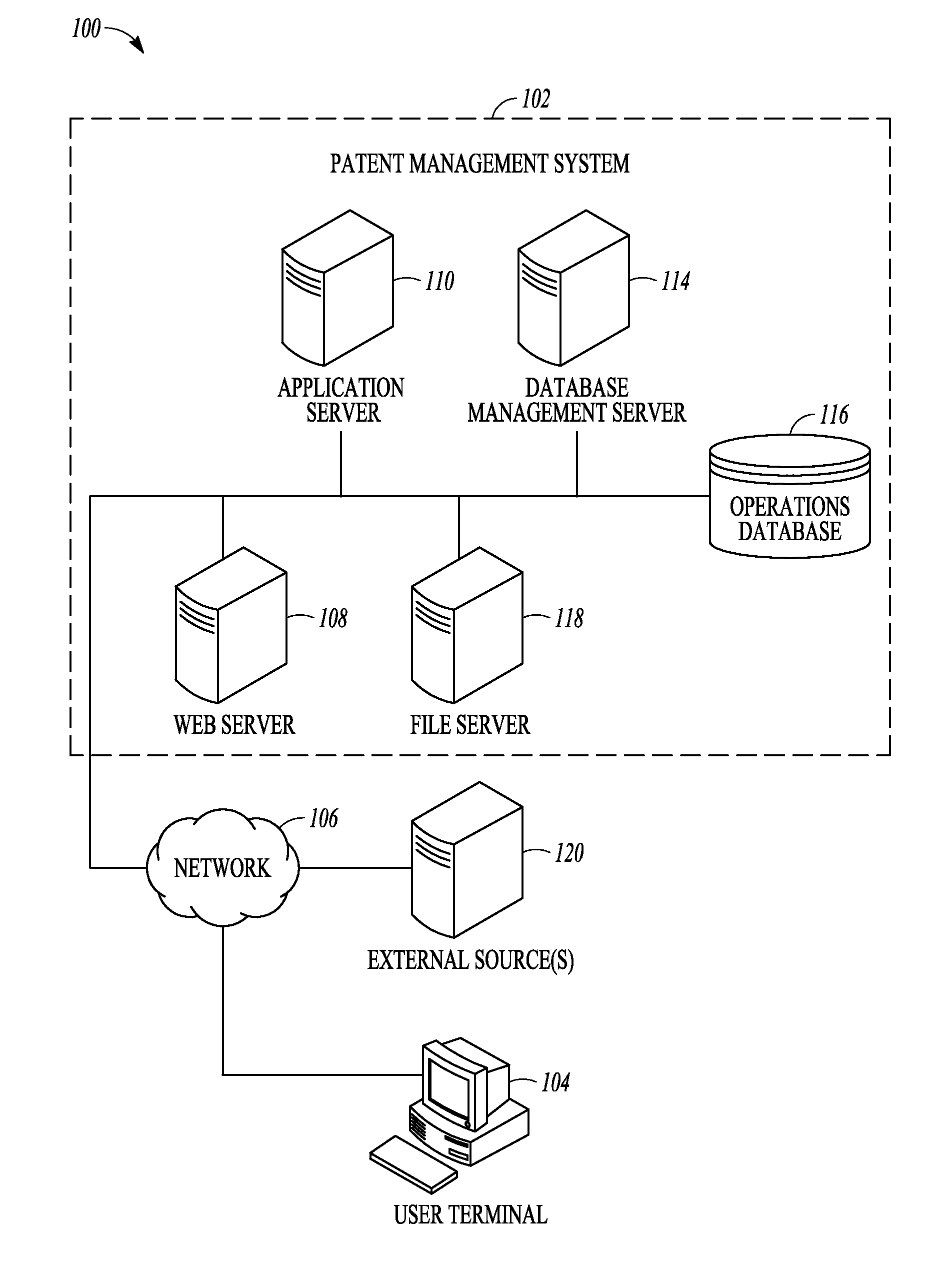

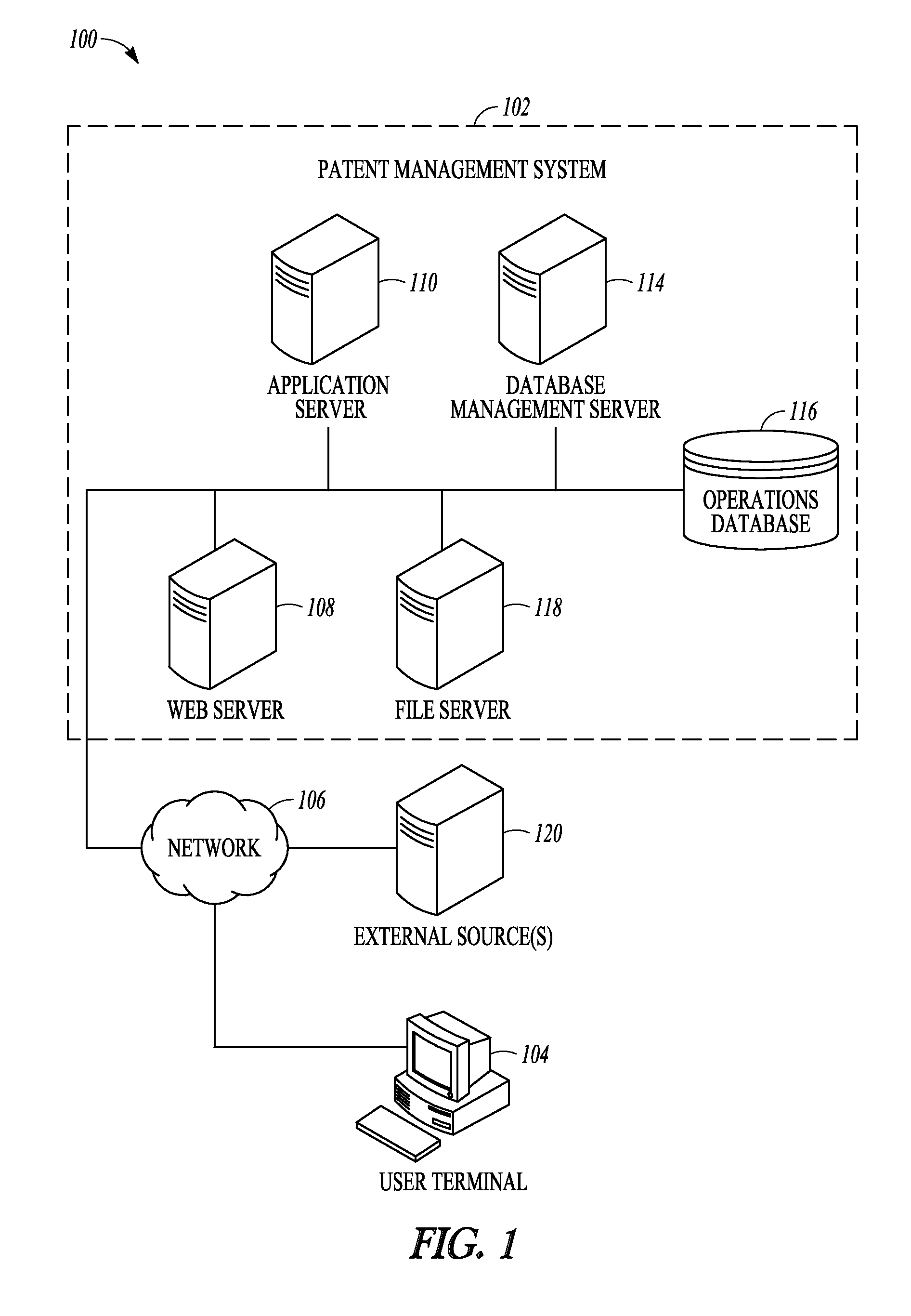

Mobile applications in patent portfolio management and annuity payments

Systems and methods for the use of mobile applications in patent portfolio management are proposed. In one example embodiment, a method includes providing or enabling a mobile application for a portable electronic device, the mobile application relating to payment of patent annuity fees and allowing presentation of an interactive user interface to a user. The method includes displaying, in the user interface, a cost projection for paying one or more patent annuity fees and allowing a user to select one or more of the displayed patent annuity fees for payment.

Owner:BLACK HILLS IP HLDG

Social media in patent portfolio management

Systems and methods for the use of social media in patent portfolio management are proposed. In one example embodiment, a method includes maintaining or accessing, by a computer processor, a database including data relating to patent applications and detecting the grant or publication of a patent application in the database. The method further includes creating, in response to the detection, in a social media network, a fan page including data relating to the granted or published patent application. The owner of the granted or published patent is identified in the social media network and invited to be a fan of the fan page.

Owner:BLACK HILLS IP HLDG

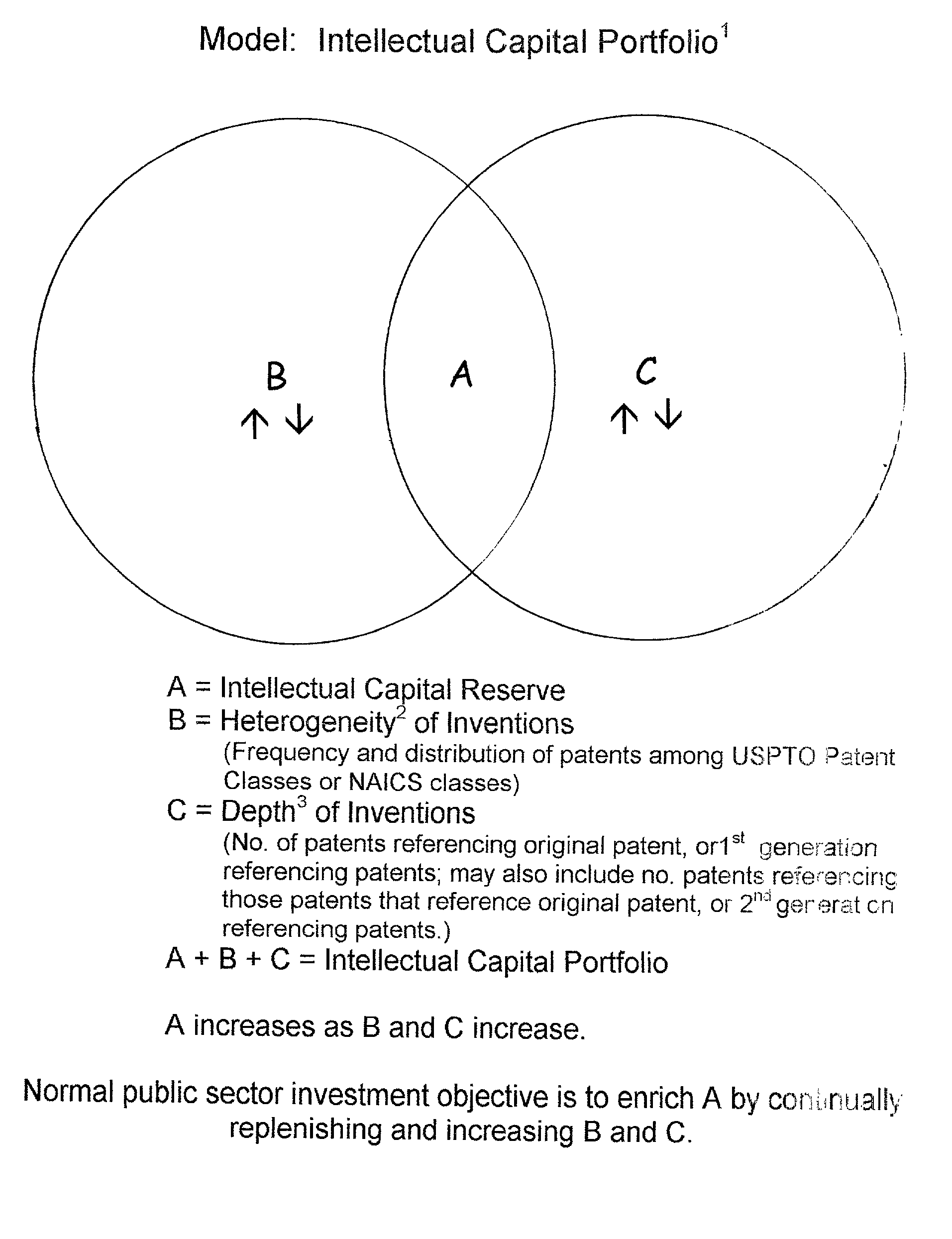

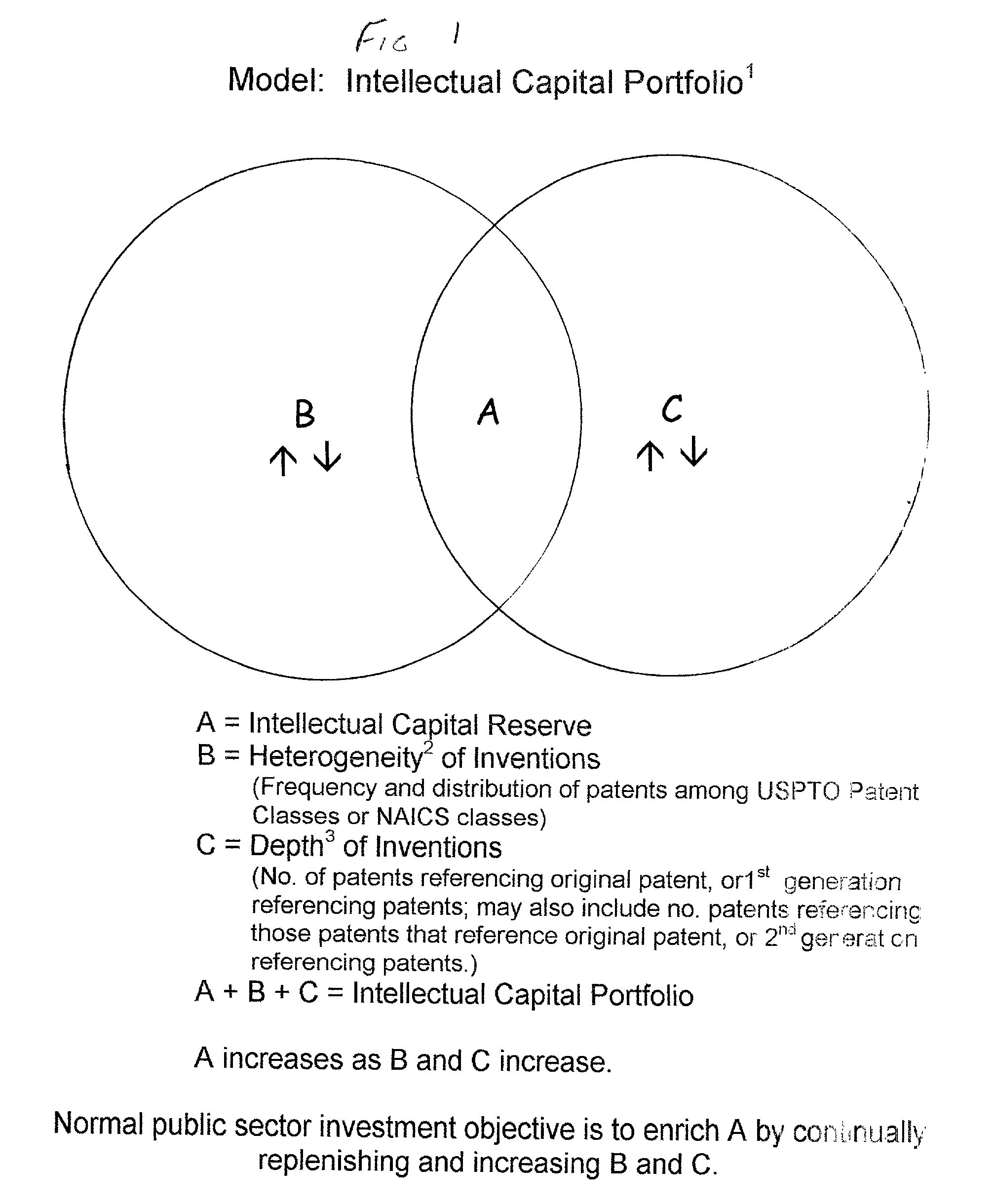

Method for evaluating a patent portfolio

A method for valuing large portfolios of publicly owned patents is disclosed. The method includes measuring the diversity and the depth of the portfolio's contents. Density or heterogeneity consists of calculating the ratio of the number of patents to the number of patented technology classes to which the patents have been assigned by the United States Patent and Trademark Office. The depth consists of the ratio of the number of patents with referencing an original patent as prior art through two generations of referencing patents. A base line for evaluation can be the utility patents awarded by the U.S. Patent and Trademark Office for the period of 1976-2000 and over time as the heterogeneity and depth increase, the value of the portfolio increases.

Owner:KRAEMER SYLVIA K

Patent guard tool

Systems and methods for the enhanced use of patent protection monitors in patent portfolio management are proposed. In one example embodiment, a method includes providing, via a website or other communication portal, a patent monitoring tool including at least one interactive user interface. A user identifies a patent for automated monitoring at a patent office. A user can select engagement of an automated advisory monitors for the identified patent. The automated monitors may include a no-assignment-filed monitor, an assignment-changed monitor, and a patent-fee monitor. The patent-fee monitor may automatically initiate a patent revival process in the event a patent fee is not paid.

Owner:BLACK HILLS IP HLDG

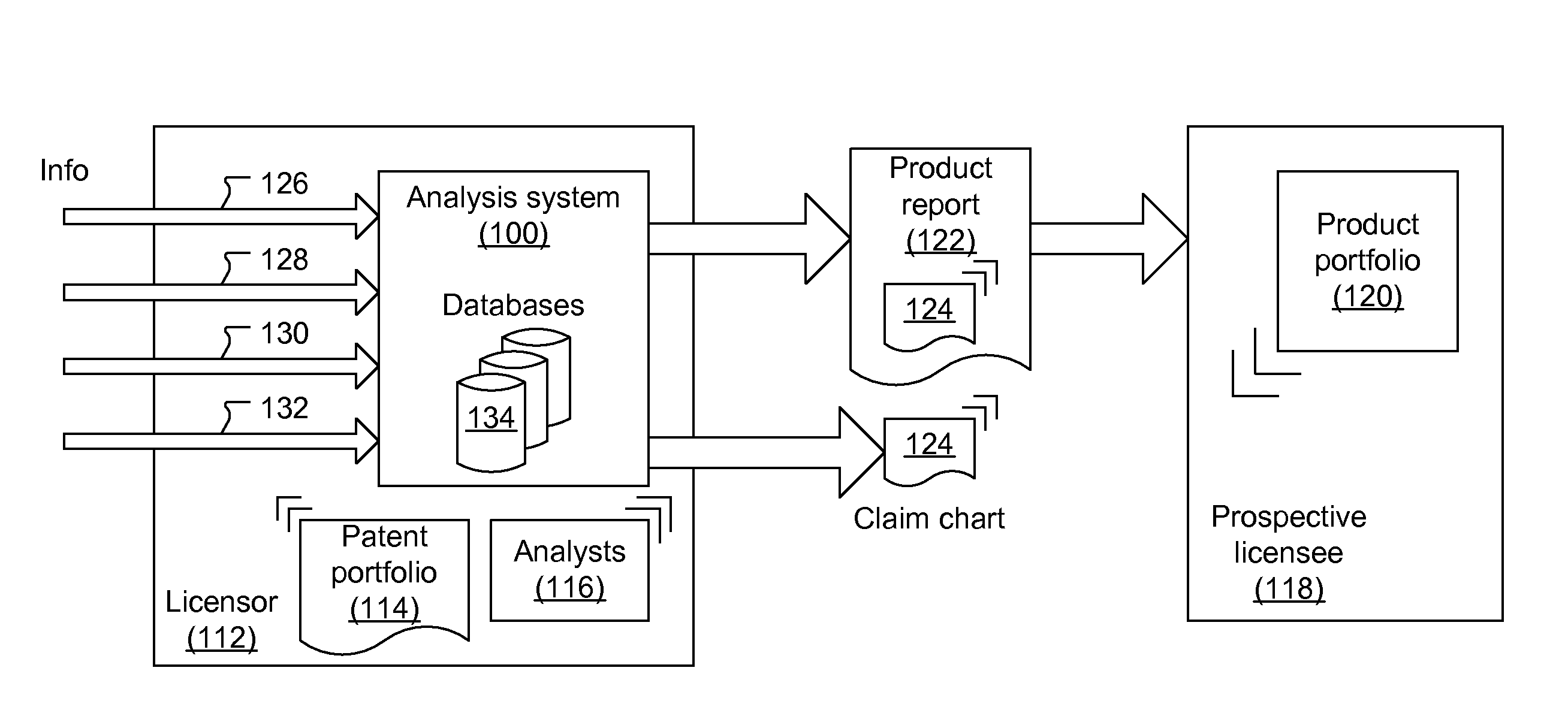

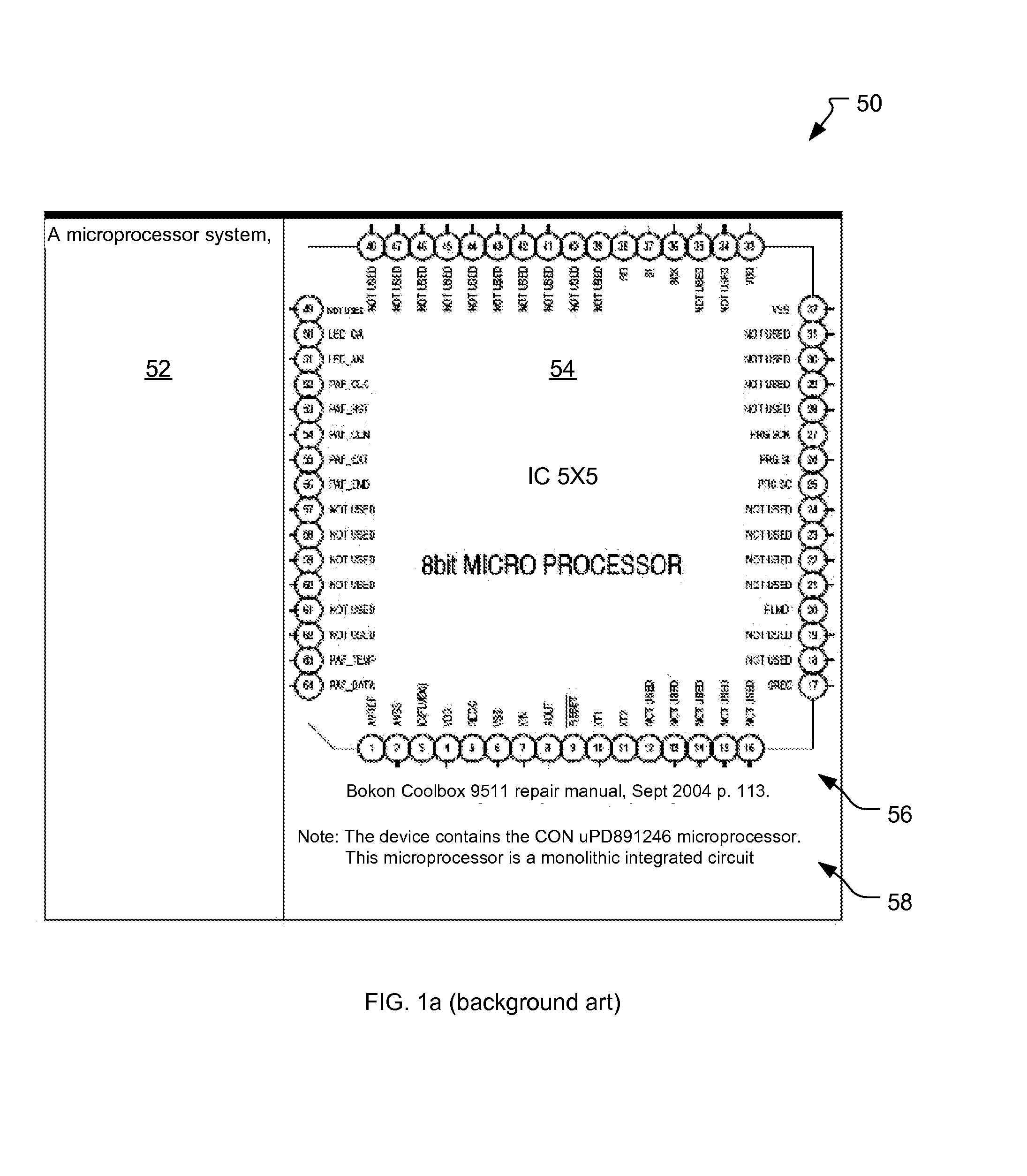

Claim chart creation system

A process for creating a claim chart. Information is maintained in a database about a patent portfolio including at least one patent including at least one claim having at least one claim element and about a product portfolio including at least one product having at least one product characteristic. A collection of proof pieces are maintained in the database each representing an assertion about a product characteristic. A current product in the product portfolio, a current patent in the patent portfolio, and a current claim in the current patent are selected. For each claim element of the current claim, an element proof is constructed by selecting a proof piece showing that a product characteristic of the current product matches the claim element. Then a document is generated showing the claim chart as a collection of the element proofs.

Owner:SCIARRINO DAVID M +1

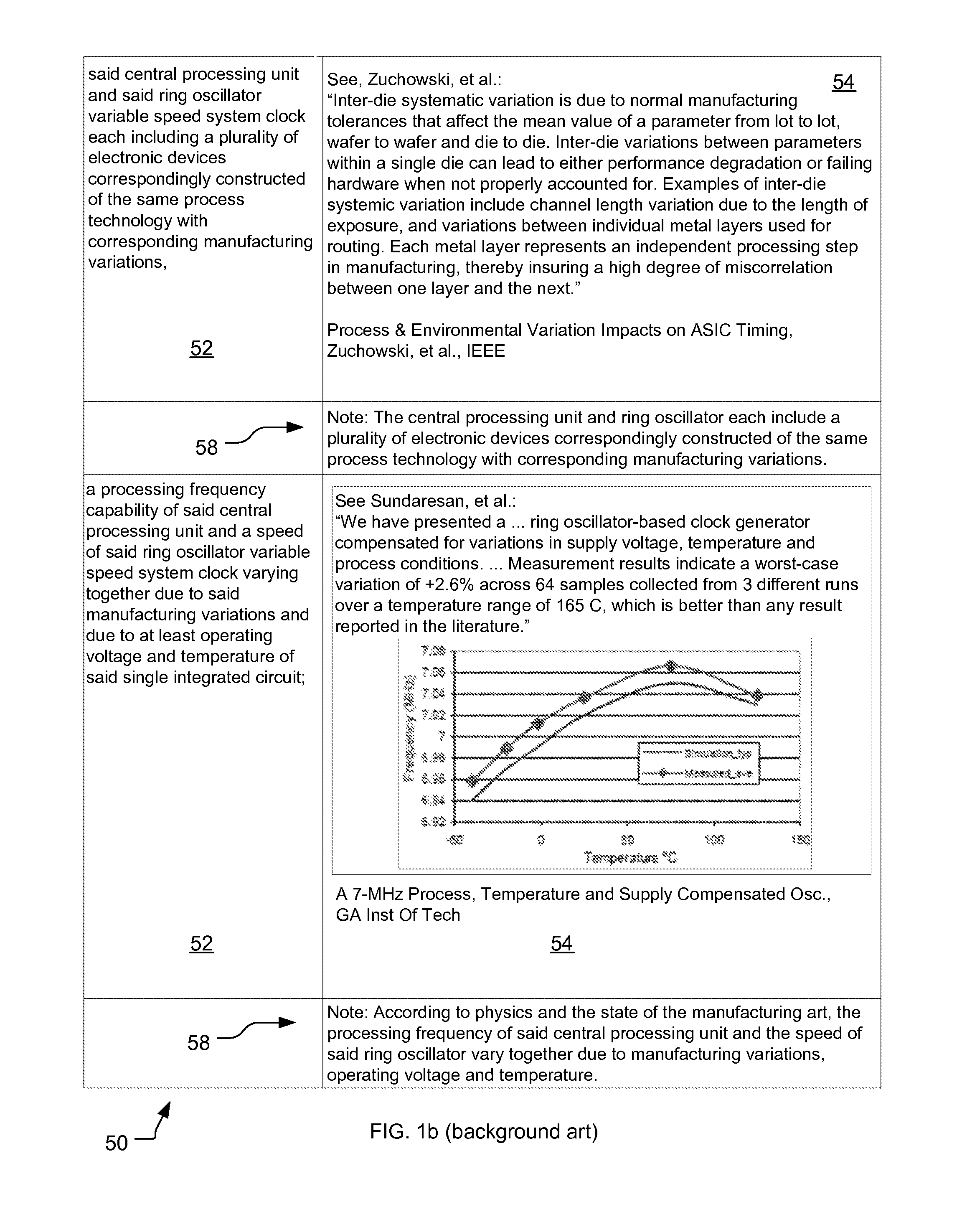

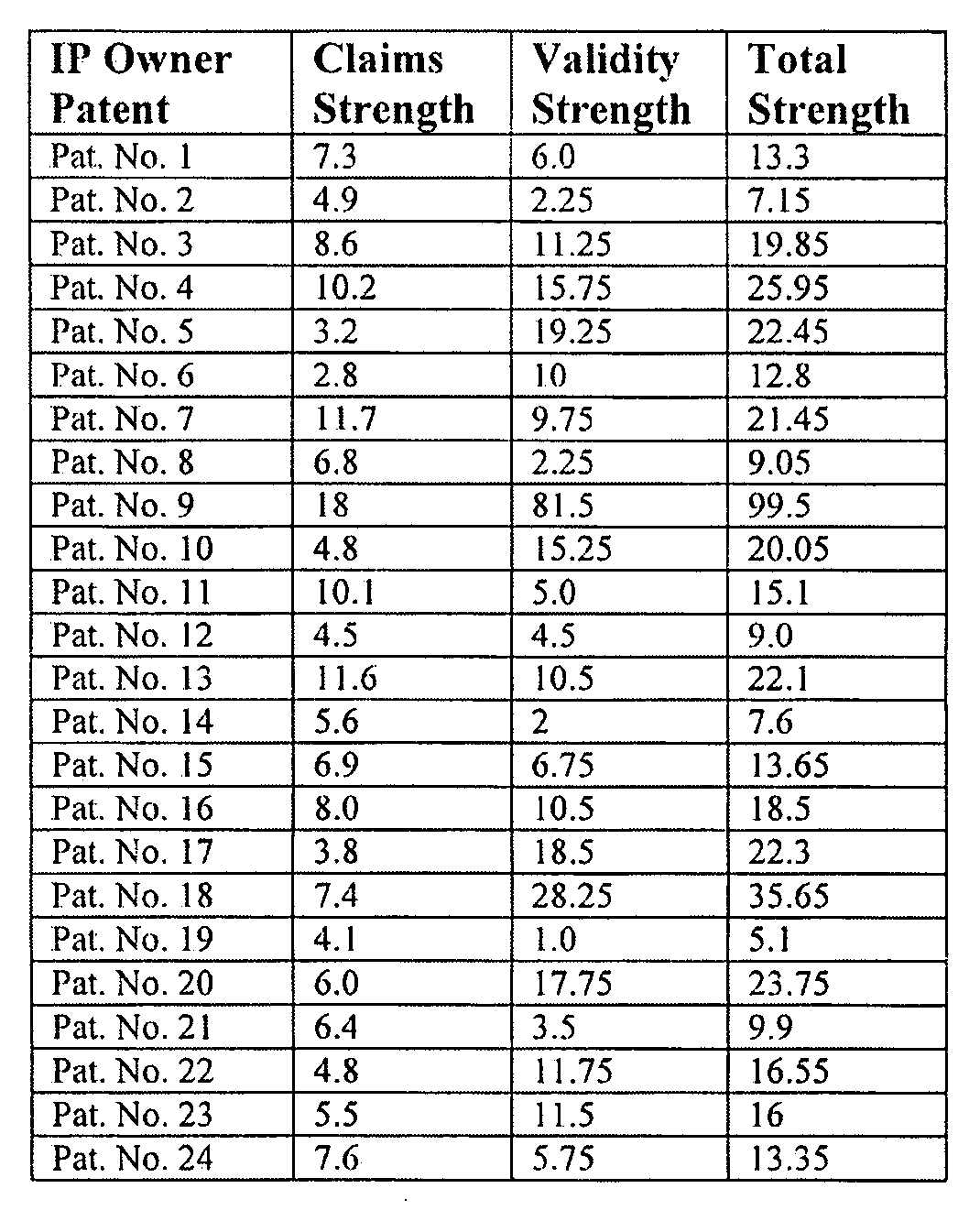

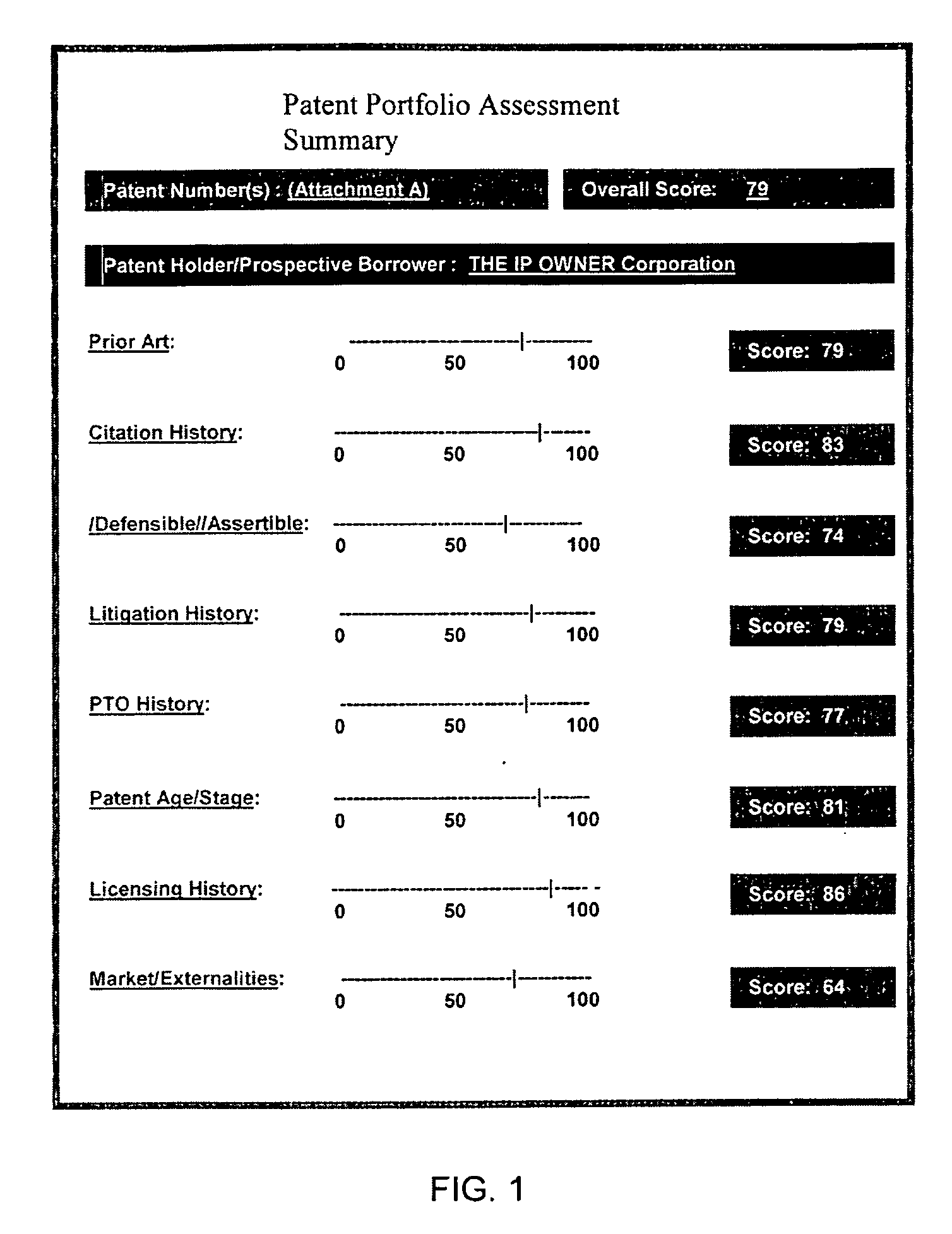

Method for assessing the strength of patent portfolios and valuating them for purposes of monetization

Owner:IPI COMML CREDIT

Computer-implemented patent portfolio analysis method and apparatus

A computer-implemented apparatus and method for performing patent portfolio analysis. The patent portfolio analysis apparatus and method clusters a group of patents based upon one or more techniques. The clustering techniques include linguistic clustering techniques (e.g., eigenvector analysis), claim meaning, and patent classification techniques. Different aspects of the clusters are analyzed, including financial, claim breadth, and assignee patent comparisons. Moreover, patents and / or their clusters are linked to the Internet in order to determine what products might be covered by the claims of the patents or whether materials on the Internet might render patent claims invalid.

Owner:ONTOLOGICS INC

Patent mapping

A system and computer implemented method are provided. The method comprises maintaining a database of patent portfolios and a database of patents, with each patent stored in the database of patents being associated with one or more patent portfolios stored in the database of patent portfolios. The method includes receiving a search query associated with a first patent portfolio; searching the first portfolio as a function of the search query; generating a seed set of search results including one or more patent claims associated with the search query, the patent claims including terms from the search query; automatically generating an expanded set of search results including one or more patent claims further associated with the search query or associated with the patent claims in the seed set of search results; and mapping the one or more patent claims to a patent concept.

Owner:BLACK HILLS IP HLDG

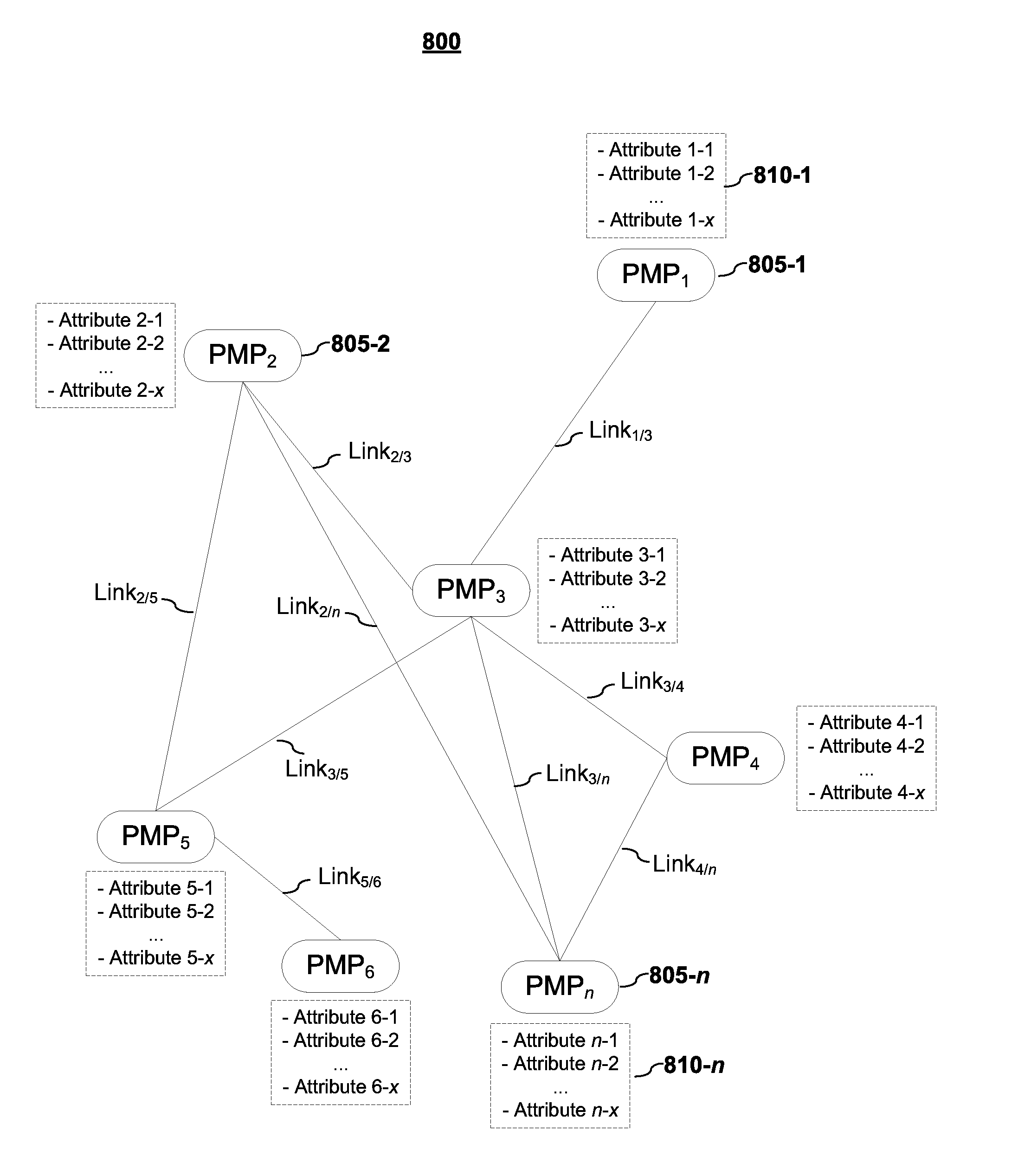

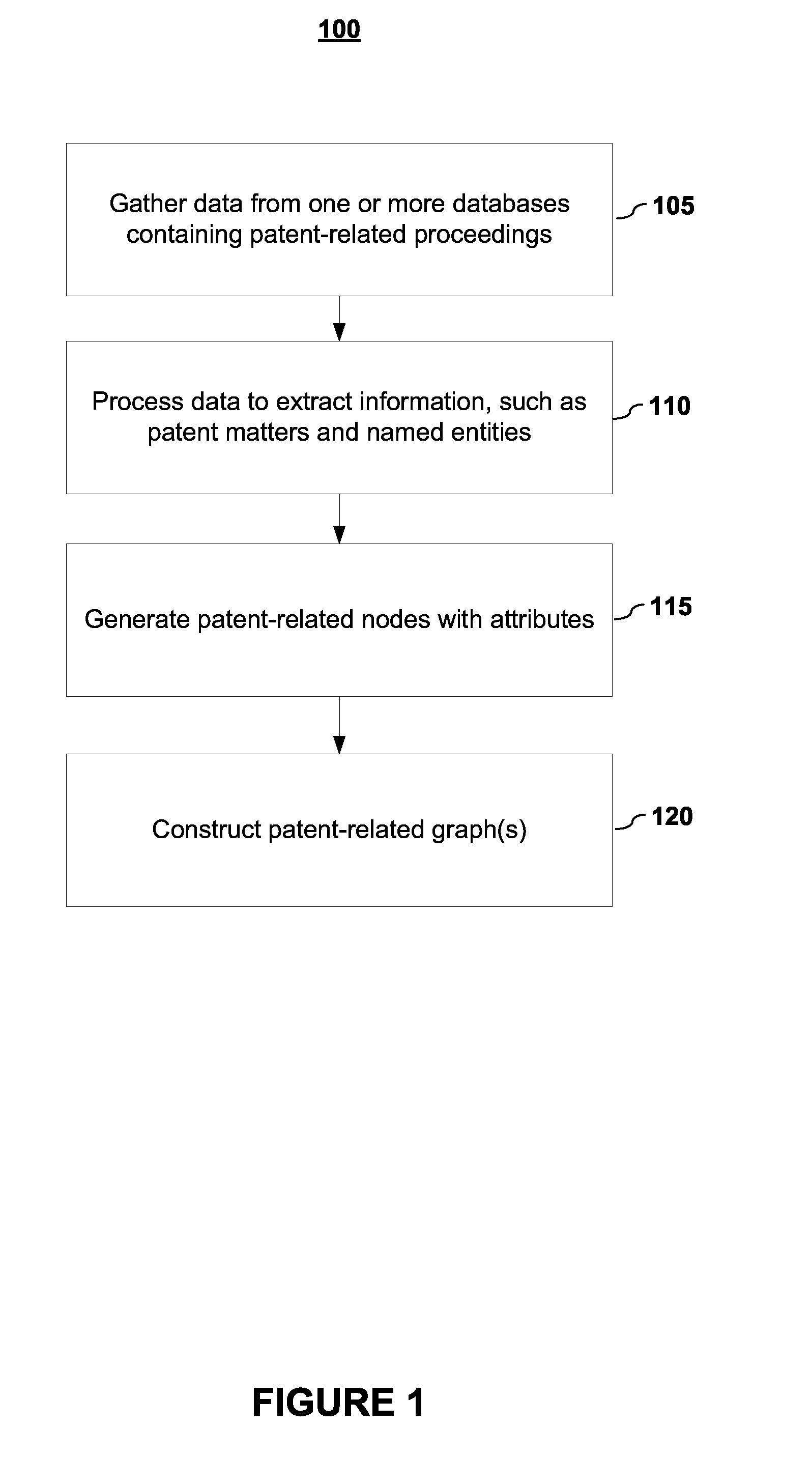

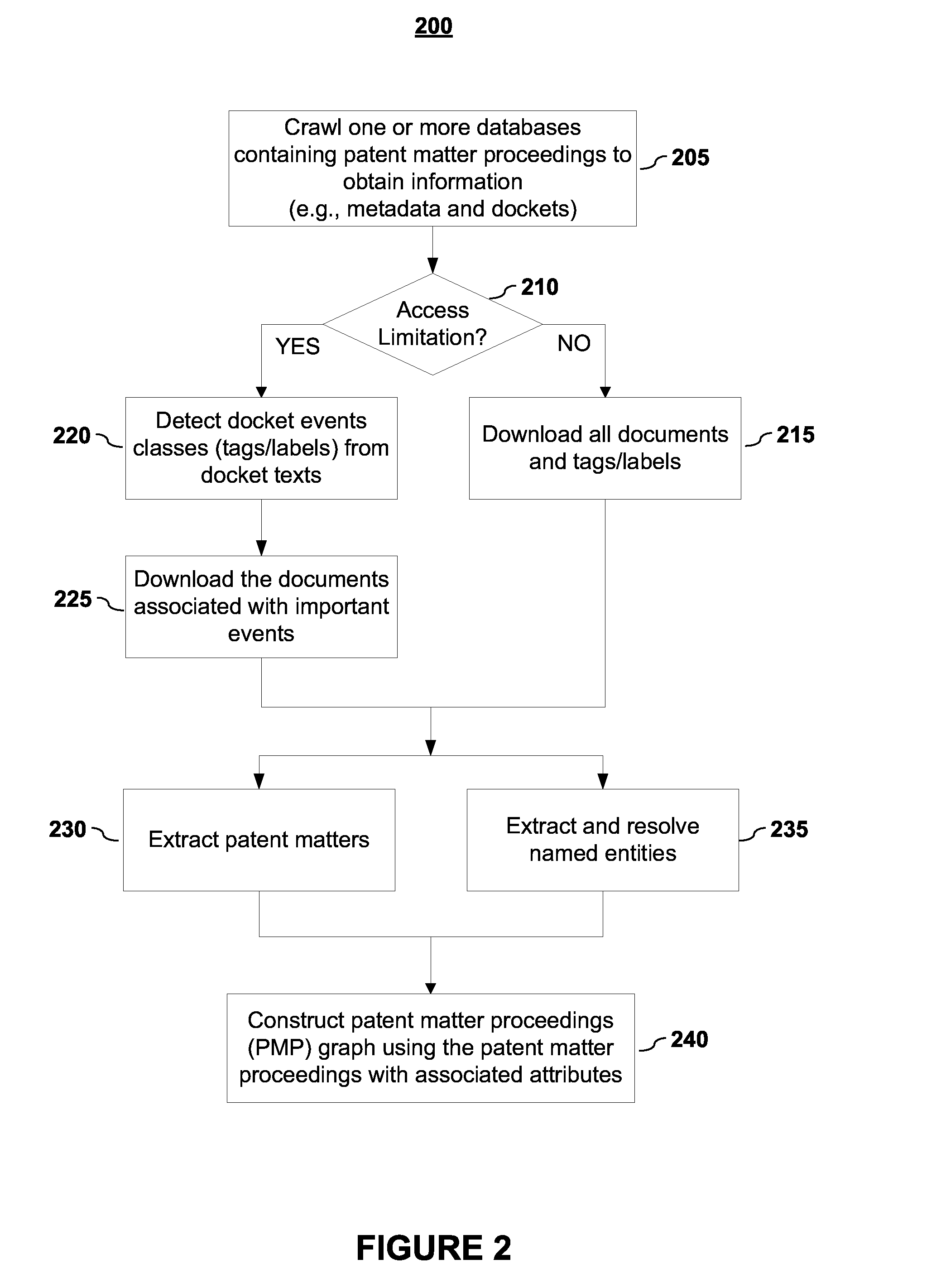

Systems and Methods for Using Non-Textual Information In Analyzing Patent Matters

Aspects of the present invention comprise using non-textual information in analyses of patent matters. In embodiments, patent matter similarity may comprise a combination of two or more metrics: (a) a metric that measures the textual similarity between an input patent portfolio and patent matters; (b) a metric that measures the behavior between portfolio patents and other patent matters at issue (e.g., which patents are asserted in the same proceeding with portfolio patents); (c) a metric that measures the textual similarity between the textual description and patent matters; and (d) a metric that inspects which patent matters are placed at issue by peer companies. In embodiments, patent matter similarity may be determined using textual similarity in combination with non-textual information.

Owner:LEX MACHINA

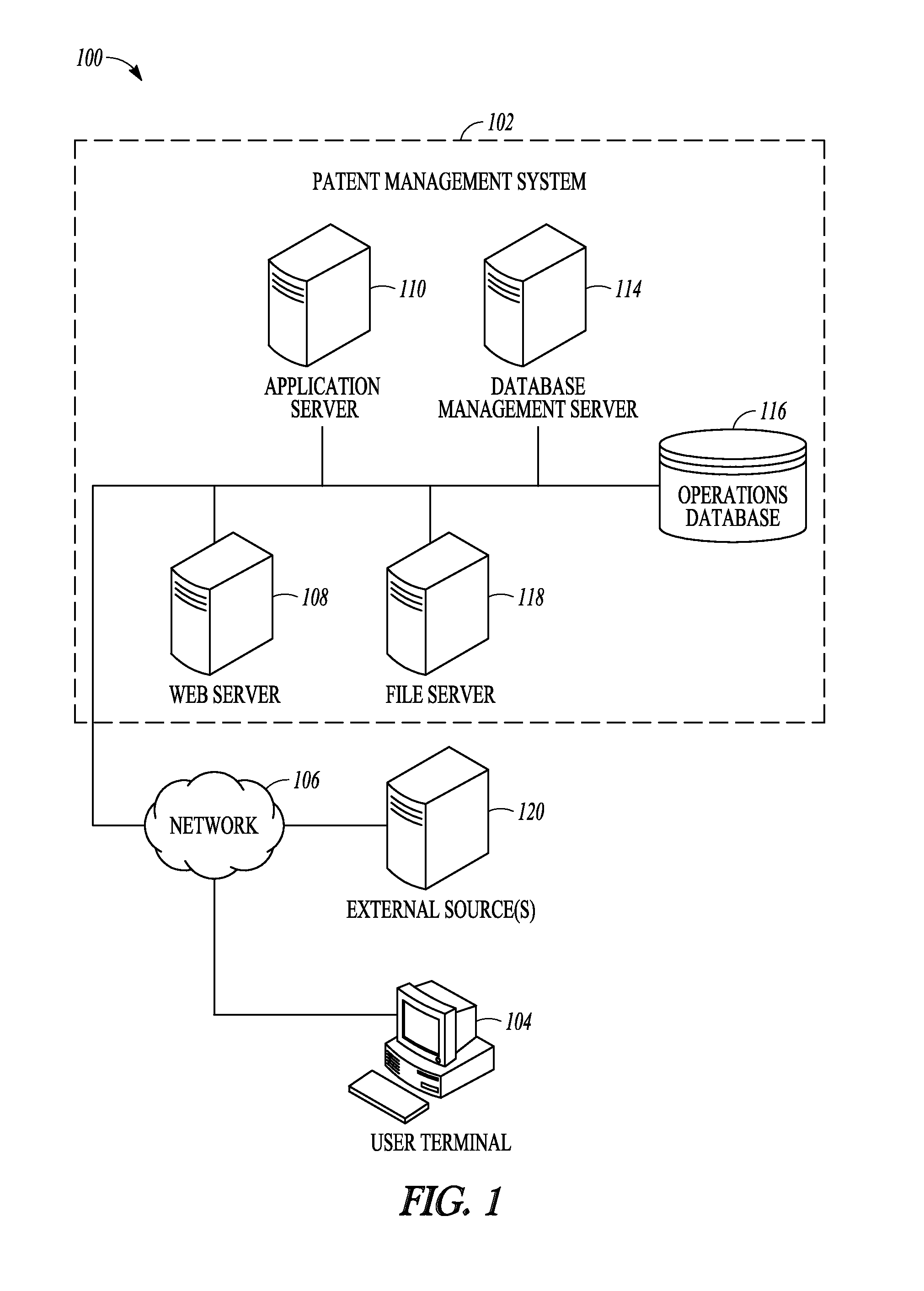

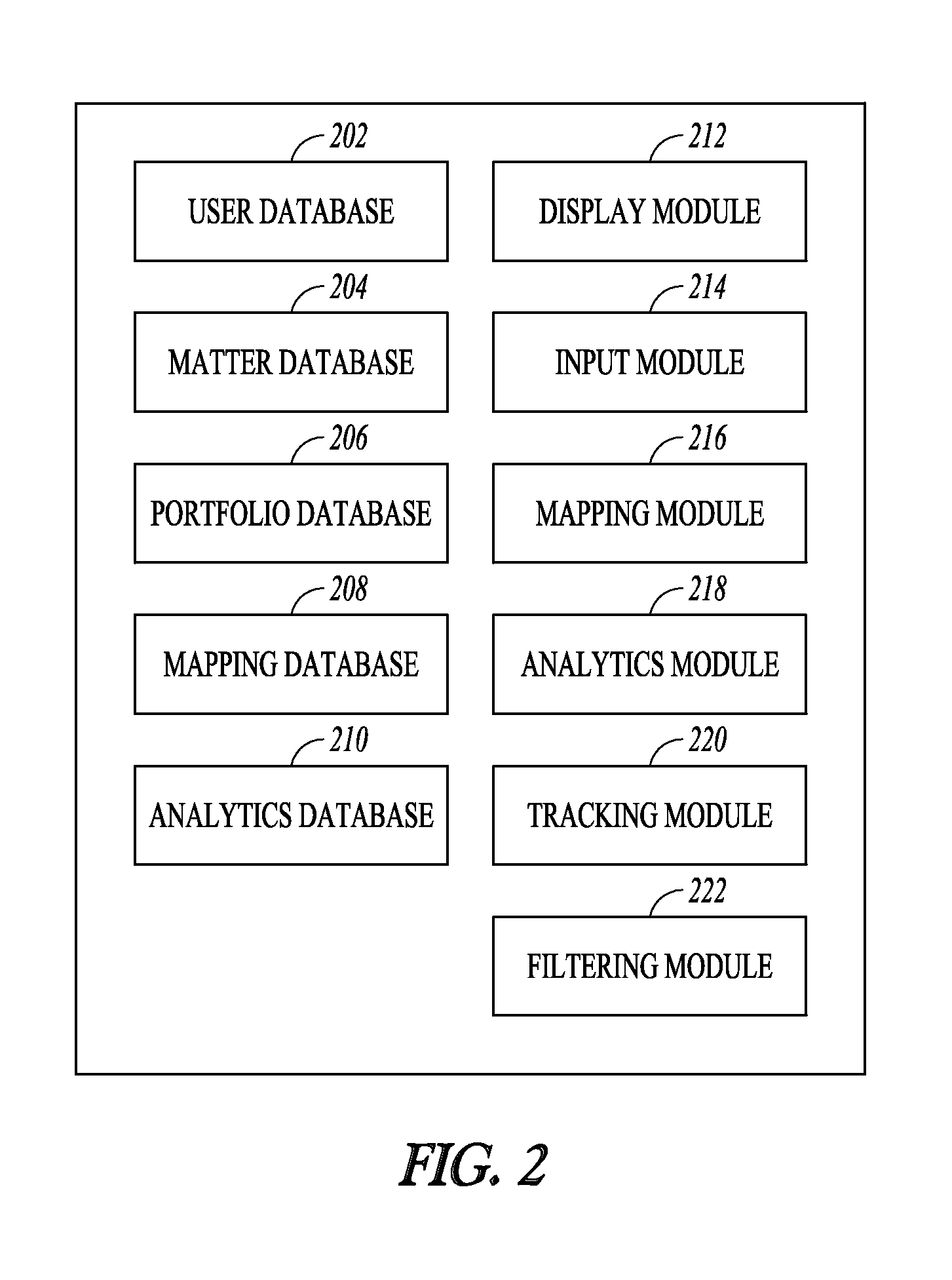

Prior art management

System and method permit prior art management. A method may comprise maintaining a database of patent portfolios and a database of patents with each patent stored in the database of patents associated with one or more patent portfolios stored in the database of patent portfolios. A method and system of prior art management may include maintaining a database of prior art portfolios, a database of patent matters, and a database of prior art reference citations, at least some of the prior art reference citations being associated with at least one of the patent matters stored in the database. Prior art references may be cross-cited between patent matters and portfolios.

Owner:BLACK HILLS IP HLDG

Patent mapping

System and method permit patent mapping. A method may comprise maintaining a database of patent portfolios and a database of patents with each patent stored in the database of patents associated with one or more patent portfolios stored in the database of patent portfolios. A search query may be received associated with a first patent portfolio and the first portfolio may be searched as a function of the search query. Search results may be generate which include one or more patent claims associated with the search query. The one or more patent claims may be mapped to a patent concept.

Owner:BLACK HILLS IP HLDG

Patent mapping

A method of patent mapping comprises maintaining a database of patent portfolios and a database of patents, each patent stored in the database of patents associated with one or more of the patent portfolios; receiving a search query associated with a first patent portfolio; searching the first portfolio as a function of the search query; generating search results, the search results including one or more patent claims associated with the search query; generating a claim similarity index for at least one patent claim or portion thereof included in the search results, based on its similarity to at least one other patent claim or portion thereof in the search results; identifying, based on the similarity index, one or more patent claims included in the search results as primary targets to map a patent scope to; and mapping the one or more patent claims to the patent concept.

Owner:BLACK HILLS IP HLDG

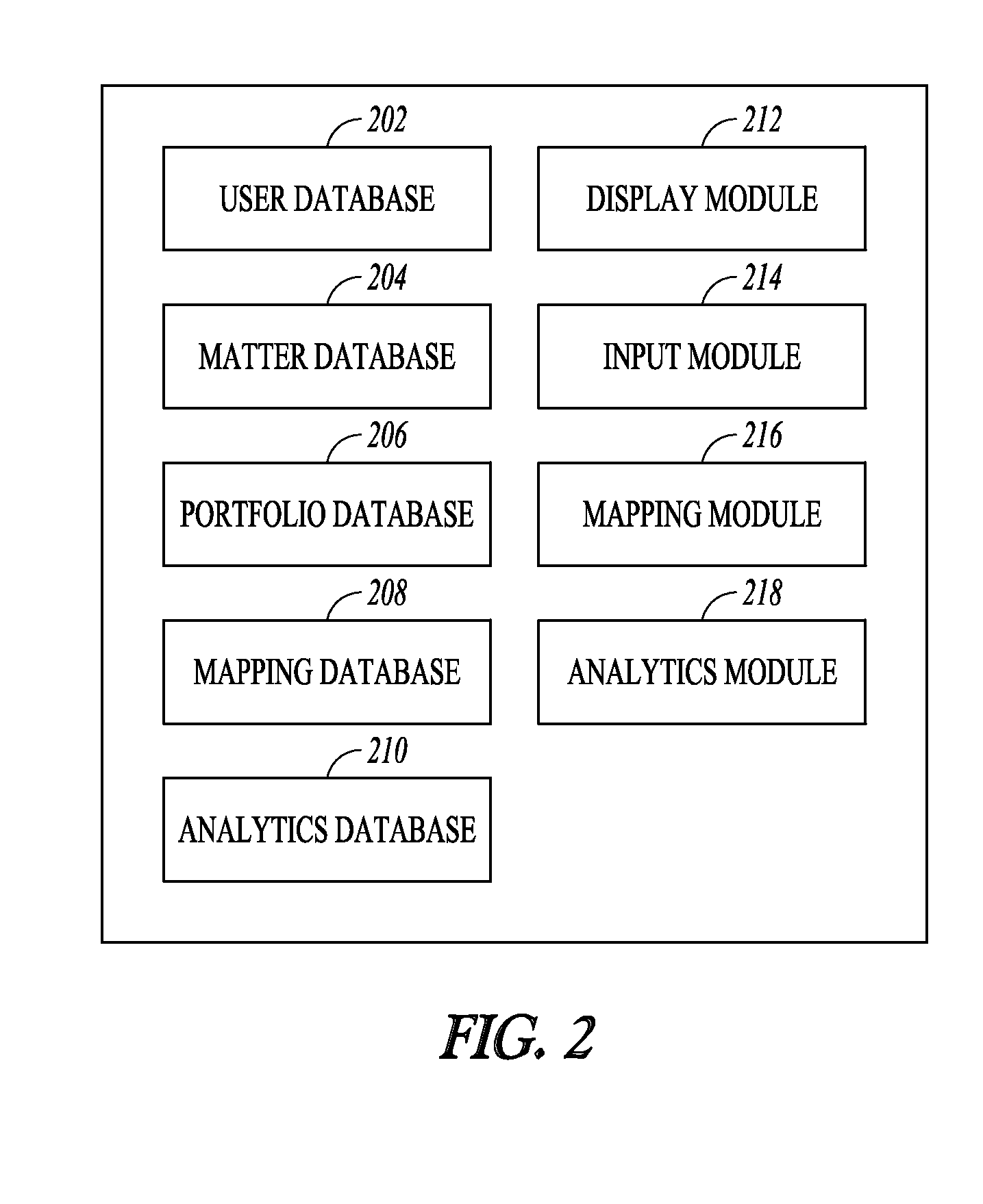

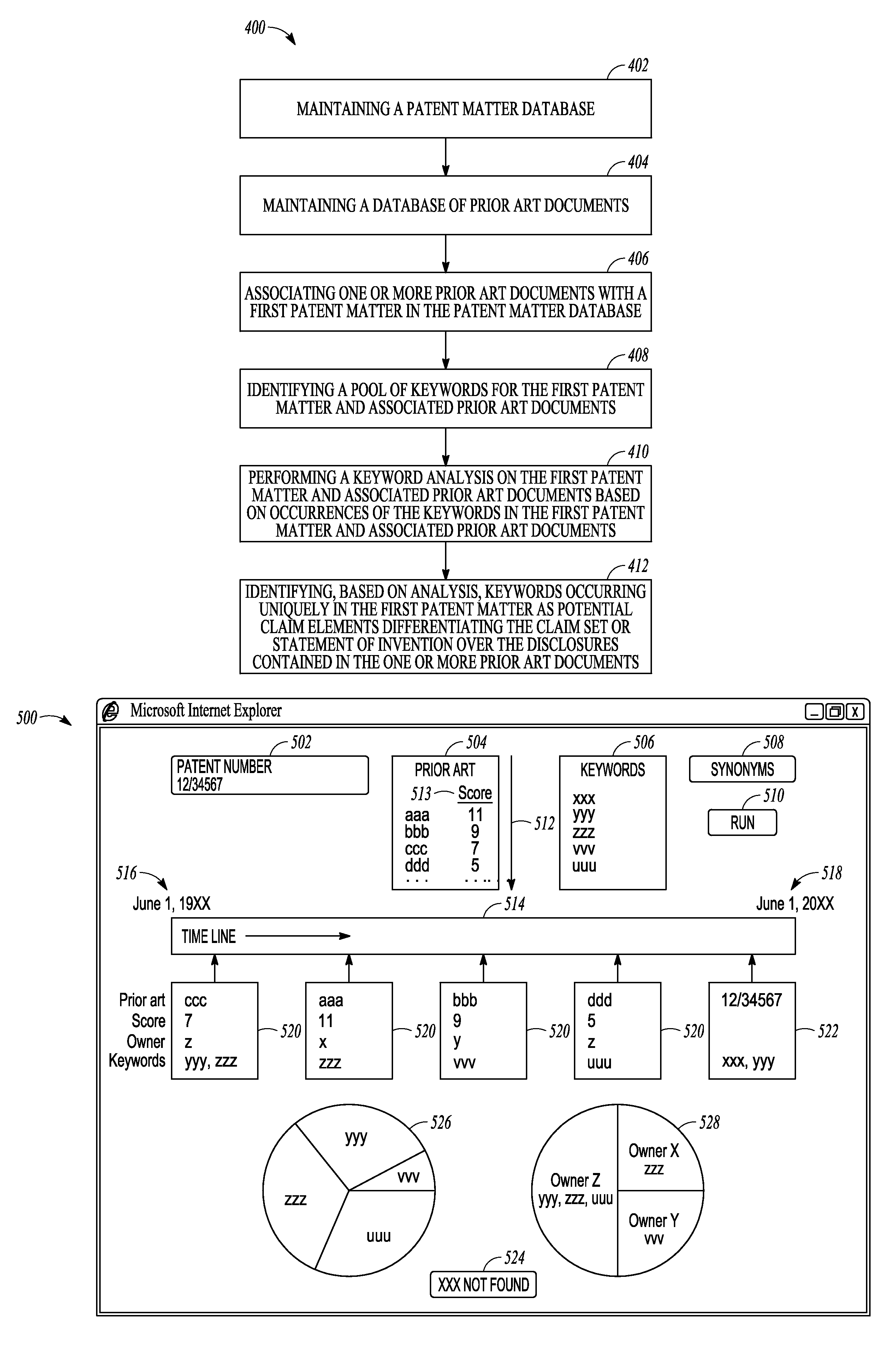

System and method for prior art analysis

The present inventive subject matter relates to prior art analysis. Various embodiments of the present inventive subject matter include systems and methods for analyzing prior art in a patent portfolio and annuity management system. In an example embodiment, a method comprises maintaining a patent matter database and a database of prior art documents including data about the prior art documents such as the priority or publication dates of the documents. A keyword analysis is performed on a given patent matter and associated prior art documents to identify keywords occurring uniquely in the first patent matter as potential claim elements differentiating the patent matter over the disclosures contained in the one or more prior art documents.

Owner:BLACK HILLS IP HLDG

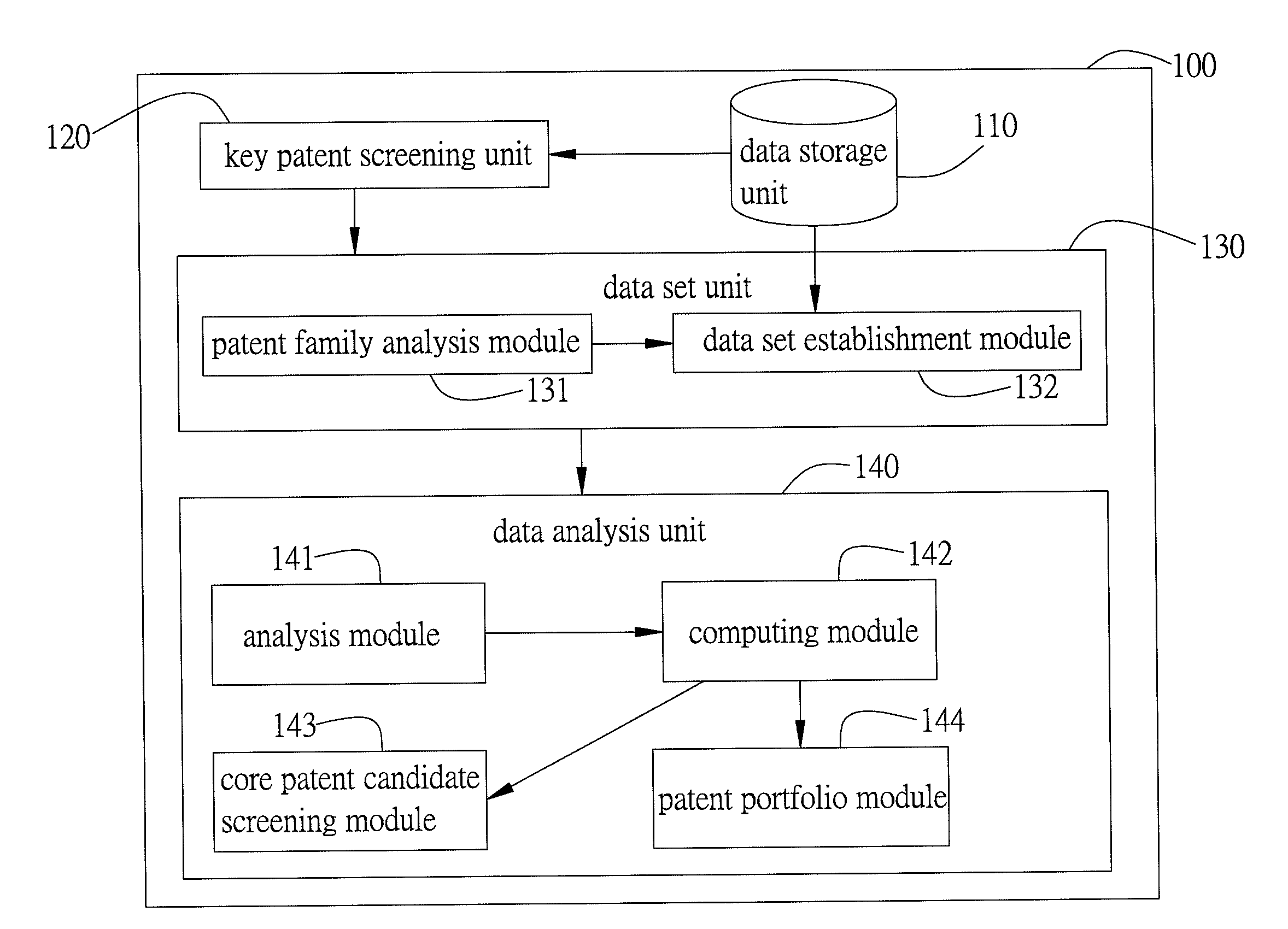

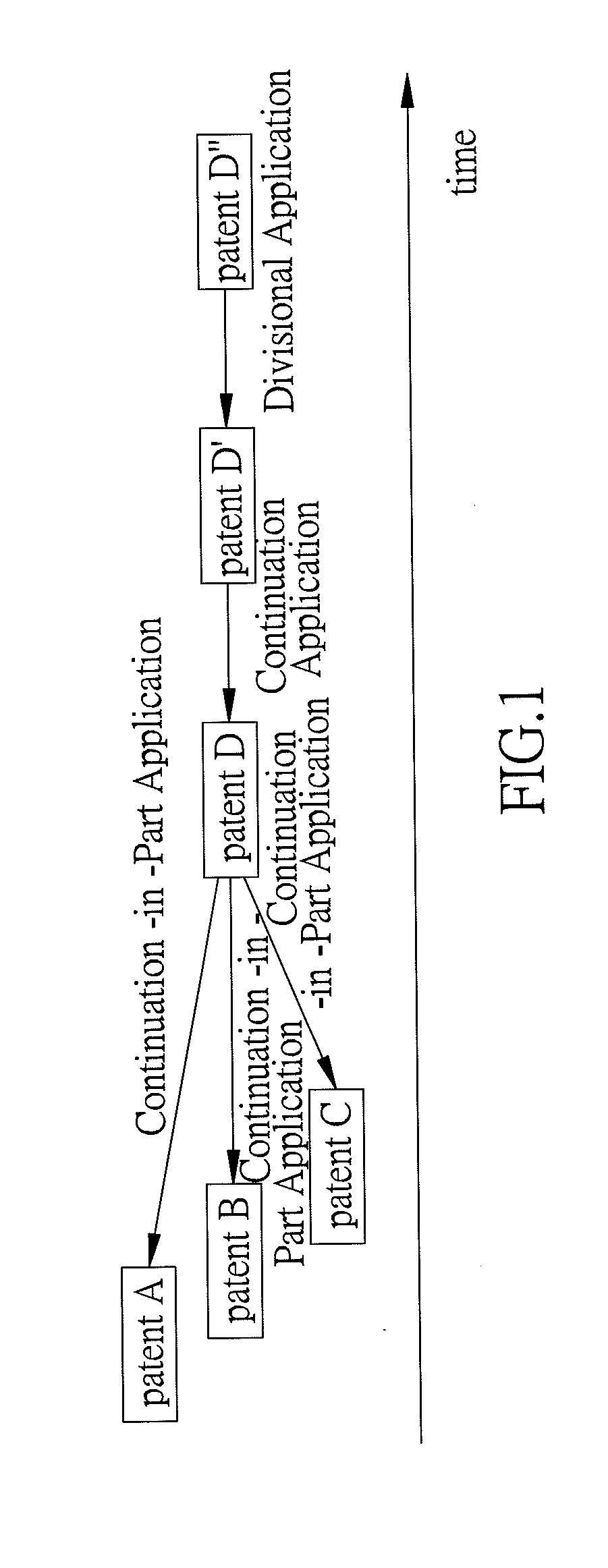

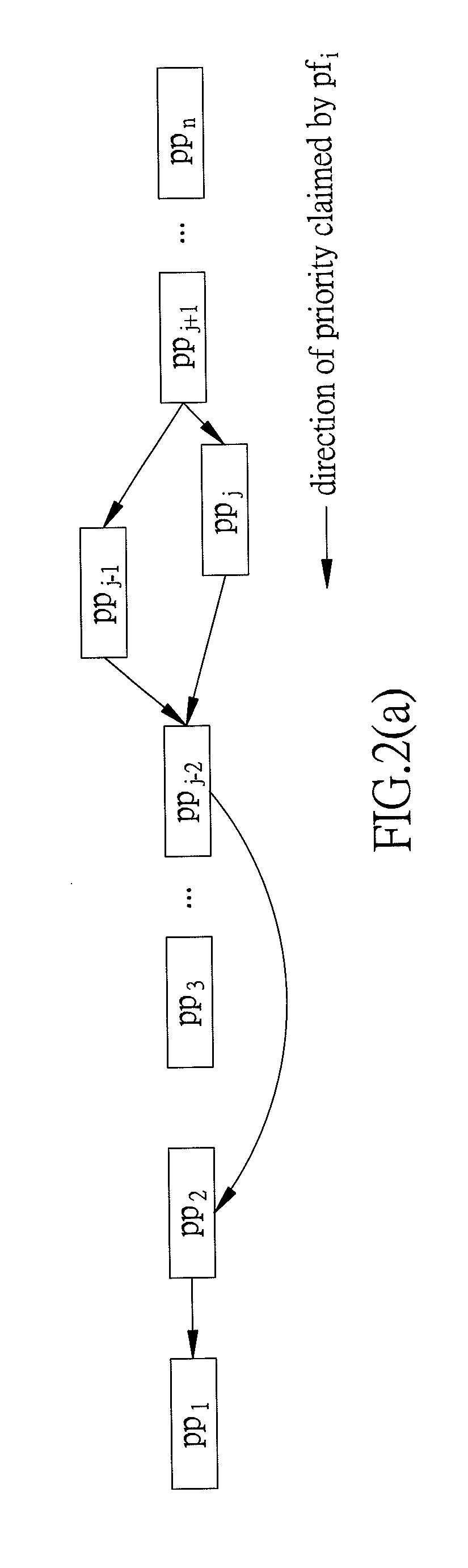

Method and system for evaluating/analyzing patent portfolio using patent priority approach

InactiveUS20120116989A1Increase the importanceIncrease valueFinanceOffice automationData setData mining

A method and a system for evaluating / analyzing patent portfolio using patent priorities are provided for selecting a patent family to establish a data set based on members of the patent family and priorities claimed by the members, forming a relationship matrix based on the members and the priorities claimed by the members in the data set and at last, and analyzing a relationship between the members of the patent family and the priorities claimed by the members of the patent family through the relationship matrix to form an analysis result and then, performing patent evaluation patent portfolio according to the analysis result. Accordingly, a patentee having numerous patents may quickly know what patents have high importance, high value and high techniques and the patentee or his competitor is facilitated to perform patent evaluation, patent portfolio, patent application and patent maintenance.

Owner:NATIONAL YUNLIN UNIVERSITY OF SCIENCE AND TECHNOLOGY

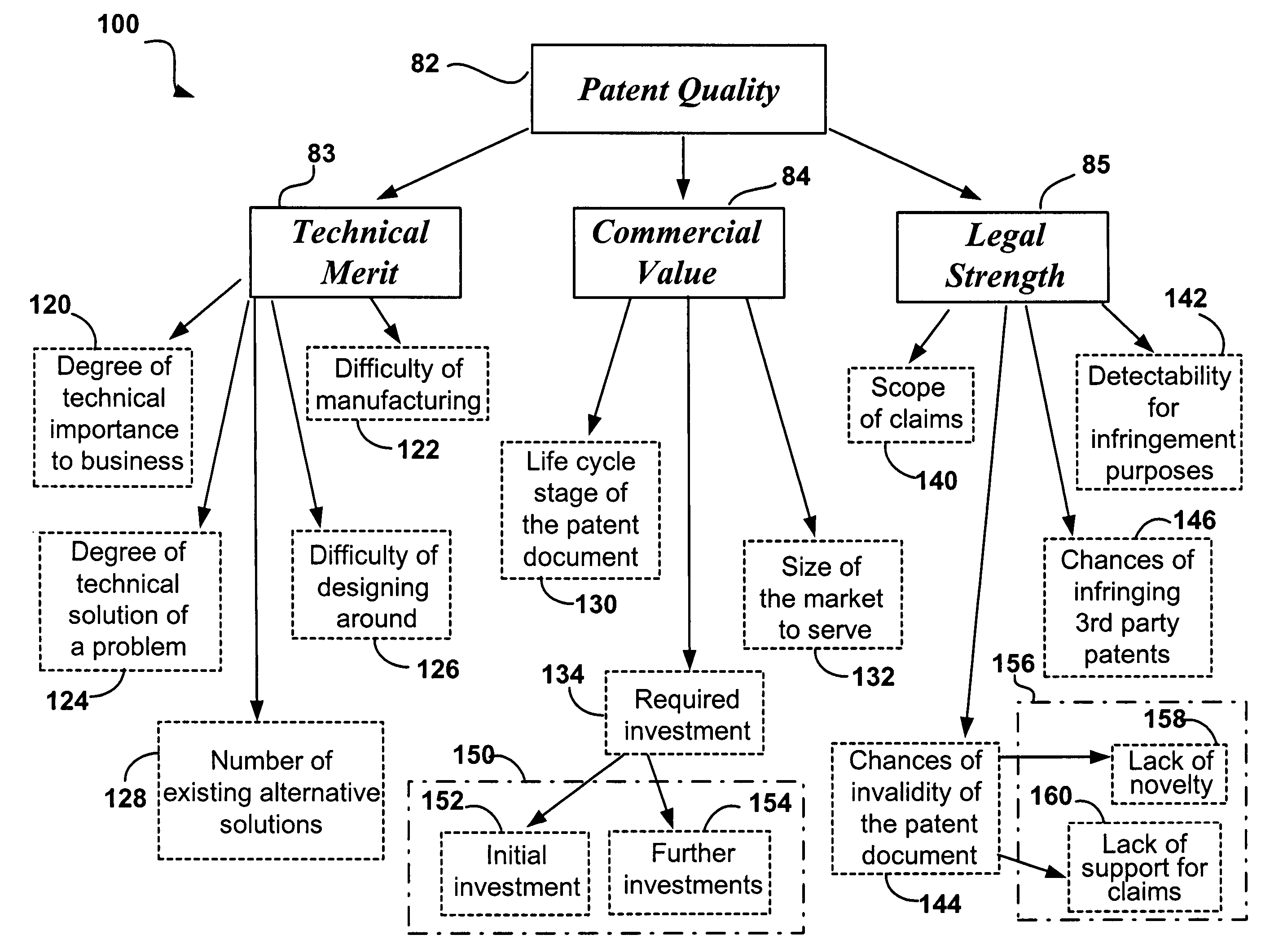

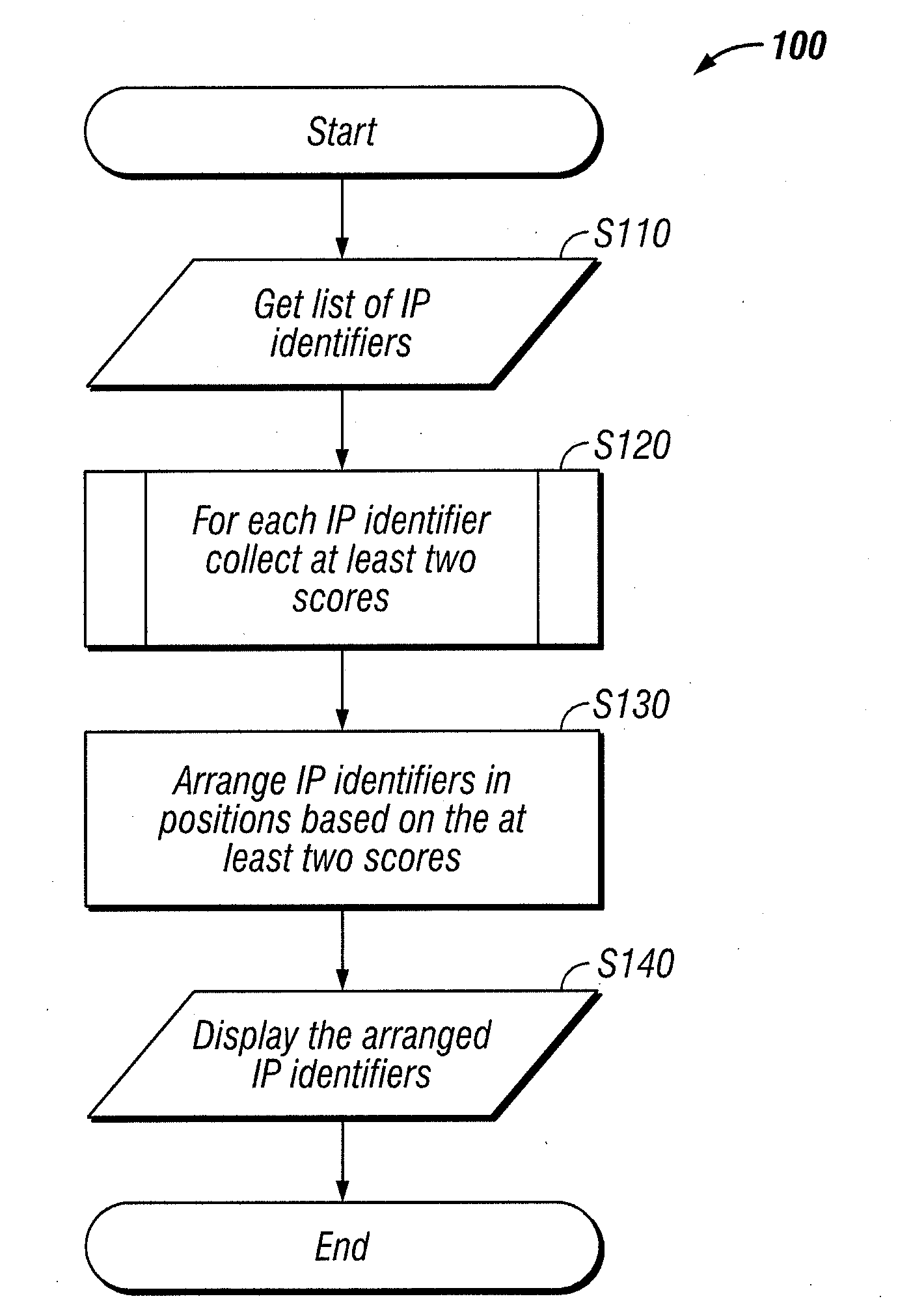

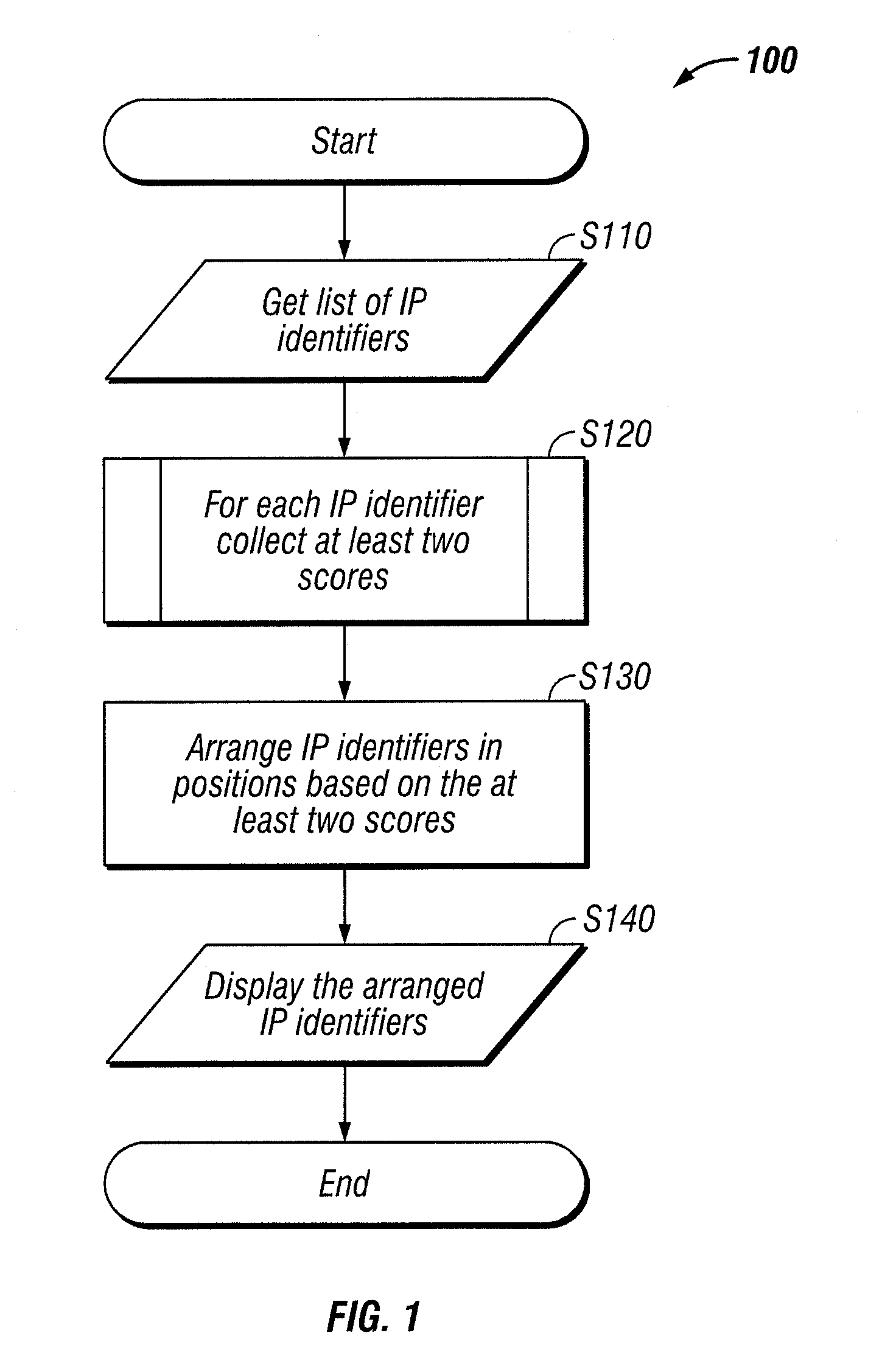

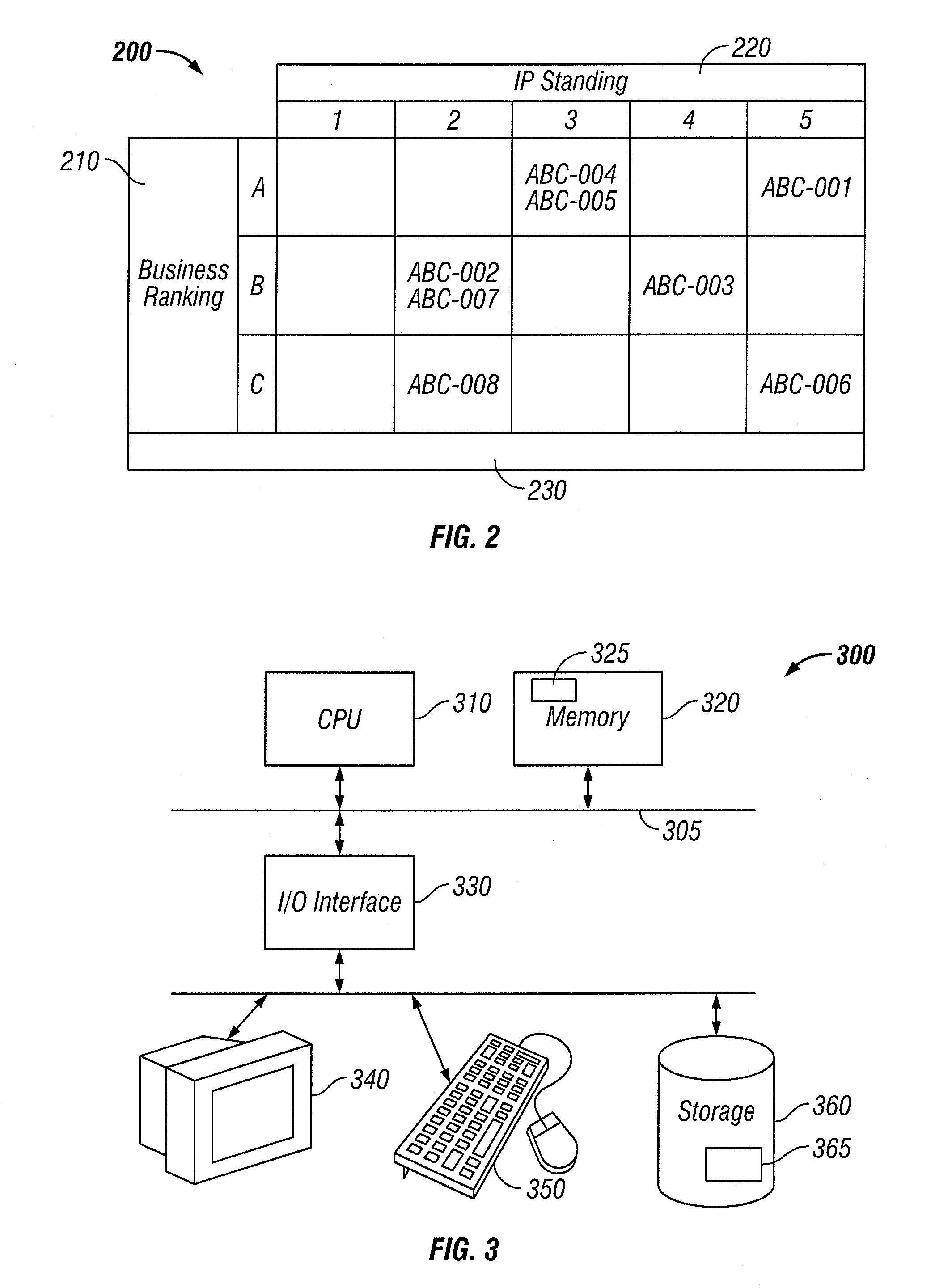

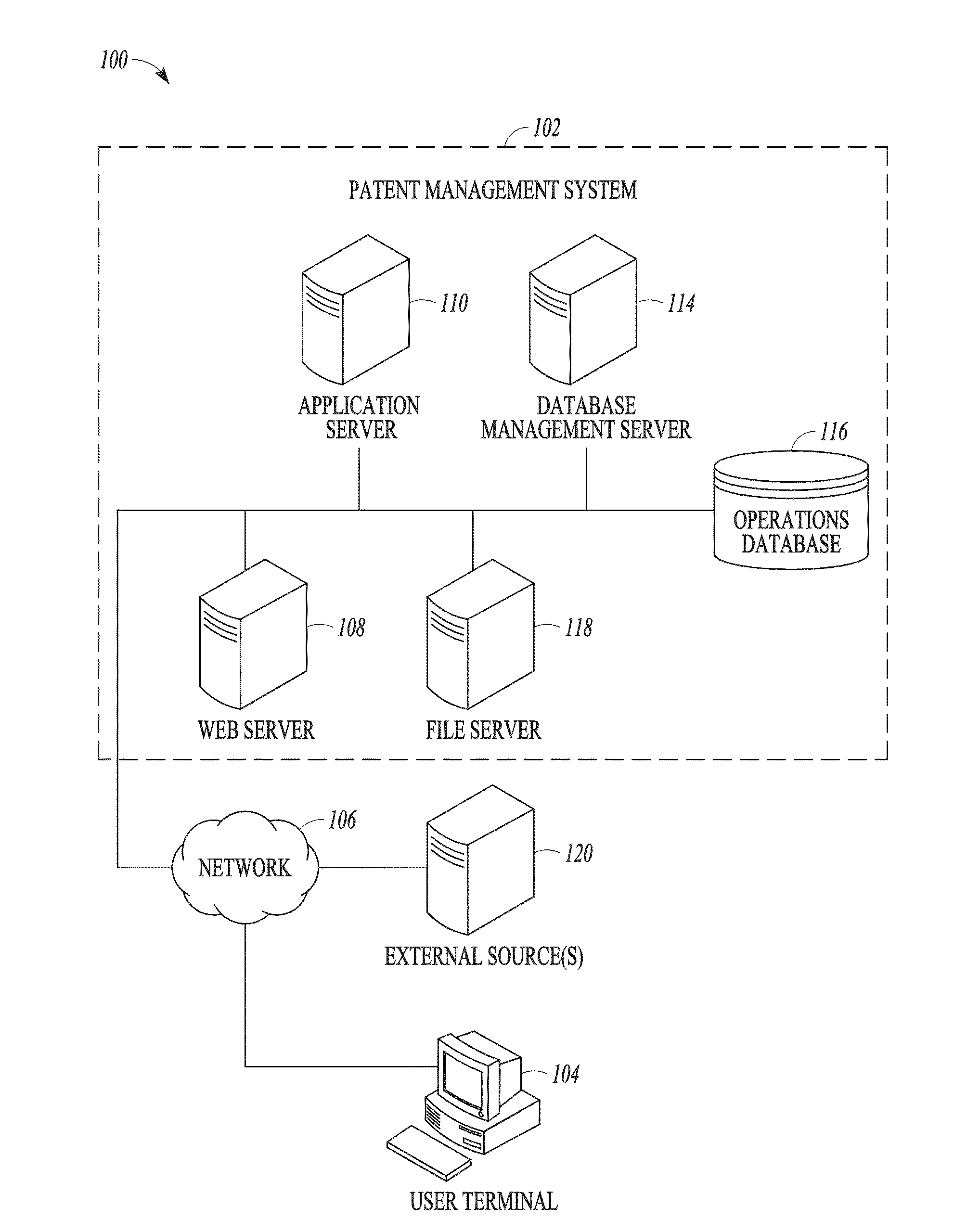

Method and apparatus for management of the creation of a patent portfolio

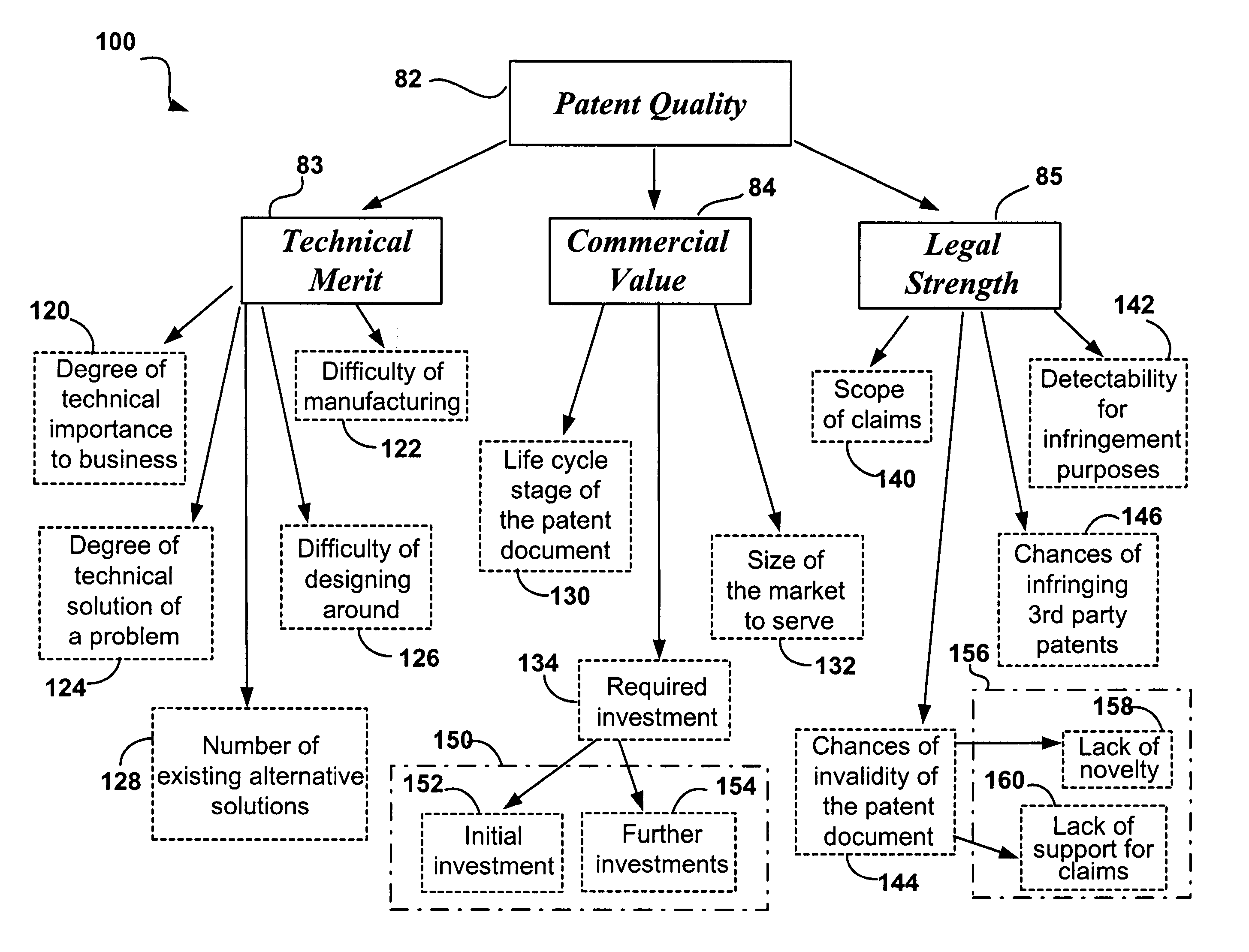

ActiveUS8538794B2Effective scoring schemeIntuitive displayFinanceOffice automationEffective solutionLibrary science

Start-up companies, as well as new businesses within established firms, have the challenge of creating a sensible intellectual property (IP) portfolio. With resources usually tight, not all of the IP can be protected due to cost or resource availability considerations. Accordingly, disclosed herein is an apparatus and method that provide an effective solution for management of identified intellectual property. By providing an effective scoring scheme and a simple display, management decision making is made simple and straightforward, while providing in a glance the entire distribution of the firm's IP.

Owner:MARKO REUVEN A +1

Patent mapping

ActiveUS20150347605A1Digital data processing detailsVisual data miningGraphicsGraphical user interface

Systems and computer implemented methods for patent mapping are provided. In one embodiment, a system comprises a database of patent portfolios and a database of patents, each patent stored in the database of patents associated with one or more patent portfolios stored in the database of patent portfolios, and one or more specially-configured modules, each including a computer processor executing on software, to perform certain operations. The operations include highlighting claim terms associated with a patent concept across a number of patent claims; storing the associations; and displaying one or more mapped patent claims and the highlighted claim terms associated with the patent concept to a user in a graphic user interface.

Owner:BLACK HILLS IP HLDG

Revenue oriented patent portfolio management

This disclosure comprises a method and system to automatically provide important business information to a user of the system at key decision making times during the lifetime of a patent with the goal of aligning business and strategies. The system will include an interface for the client to input information regarding business strategy on a continual basis and another interface to present the compiled information to the client at a later time, or to the working attorney. That information will be automatically sent to key decisions makers throughout the lifetime of a patent. Specifically, the business strategy information will consist of a revenue contribution ranking for client products as well as the competitors' products for each geographic region for which the invention is to be made, sold or transported.

Owner:BLACK HILLS IP HLDG

Patent mapping

A system and computer implemented method of patent mapping is provided. The method comprises maintaining a database of patent portfolios and a database of patents, each patent stored in the database of patents associated with one or more patent portfolios stored in the database of patent portfolios; receiving a search query associated with a first patent portfolio; searching the first portfolio as a function of the search query; generating search results, the search results including one or more independent patent claims associated with the search query; mapping the one or more independent patent claims to at least one patent concept; and associating the at least one mapped patent concept to one or more patent claims which are dependent on the one or more independent patent claims.

Owner:BLACK HILLS IP HLDG

Patent mapping

A computer implemented method and system for patent mapping comprises maintaining a database of patent portfolios and a database of patents, each patent stored in the database of patents associated with one or more patent portfolios stored in the database of patent portfolios; receiving a search query associated with a first patent portfolio; searching the first portfolio as a function of the search query; generating search results, the search results including one or more patent claims associated with the search query; mapping the one or more patent claims to a patent concept; highlighting any claim terms associated with the patent scope across a number of claims; storing the associations; and displaying the highlighted claim terms to a user when subsequently displaying the one or more mapped patent claims.

Owner:BLACK HILLS IP HLDG

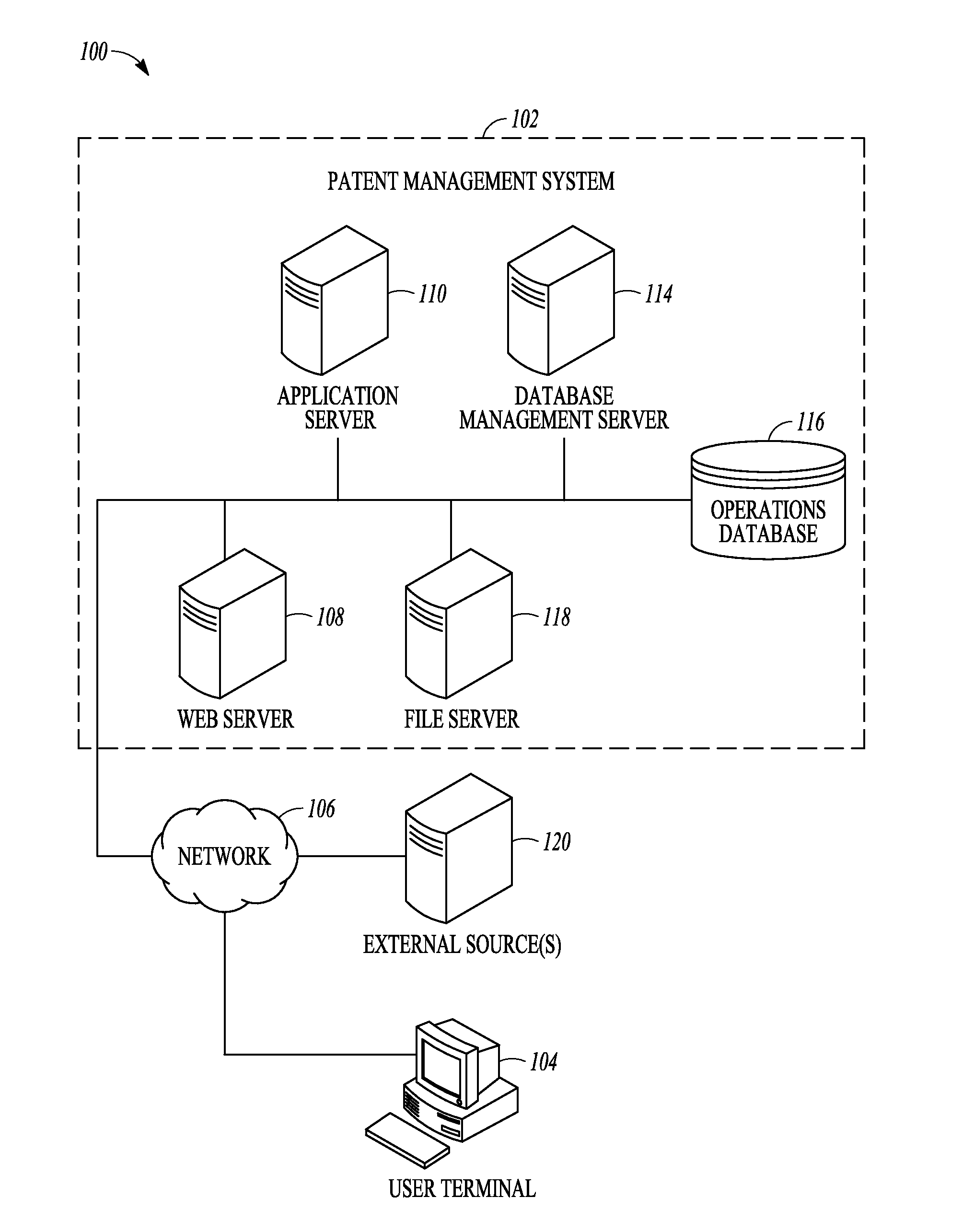

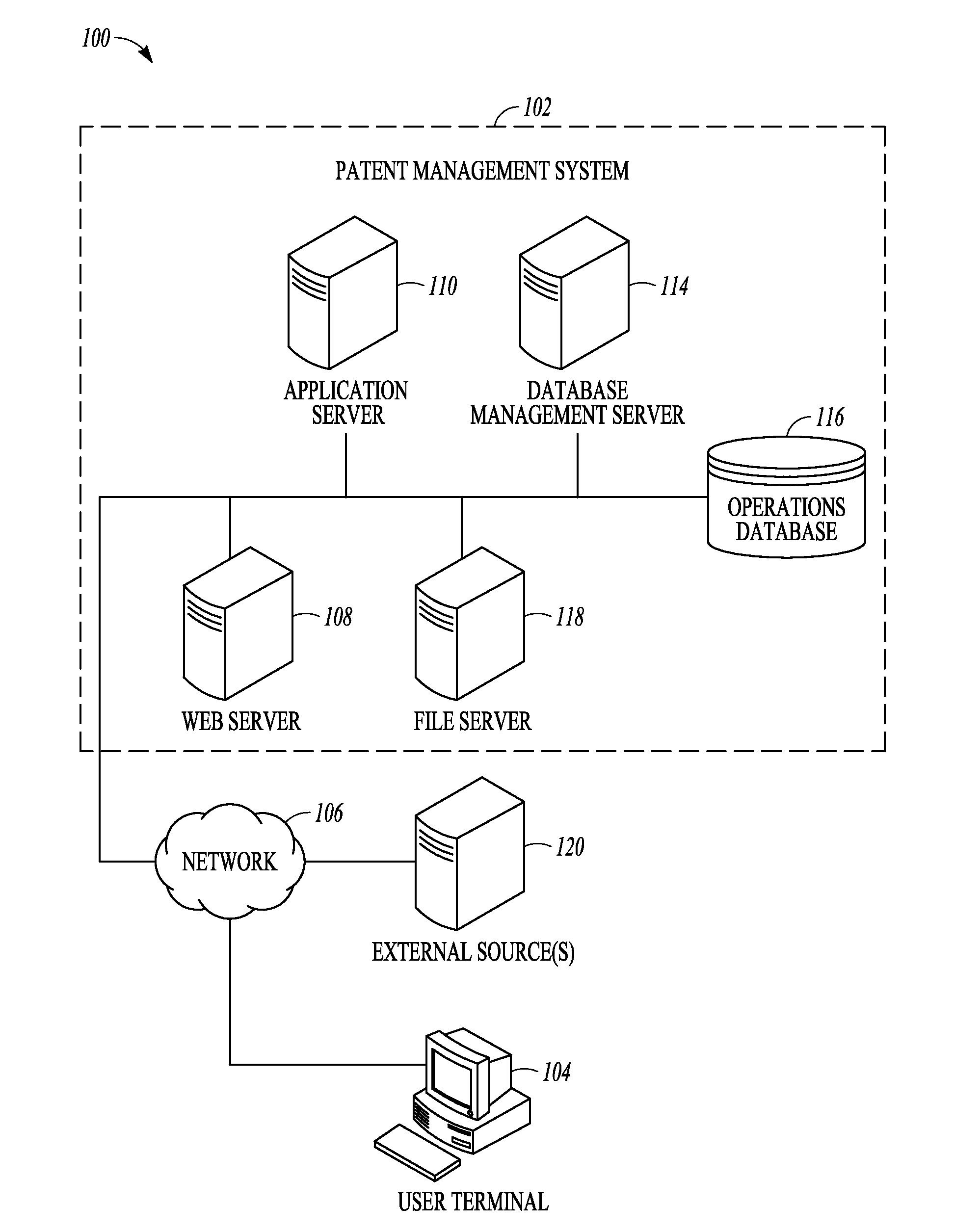

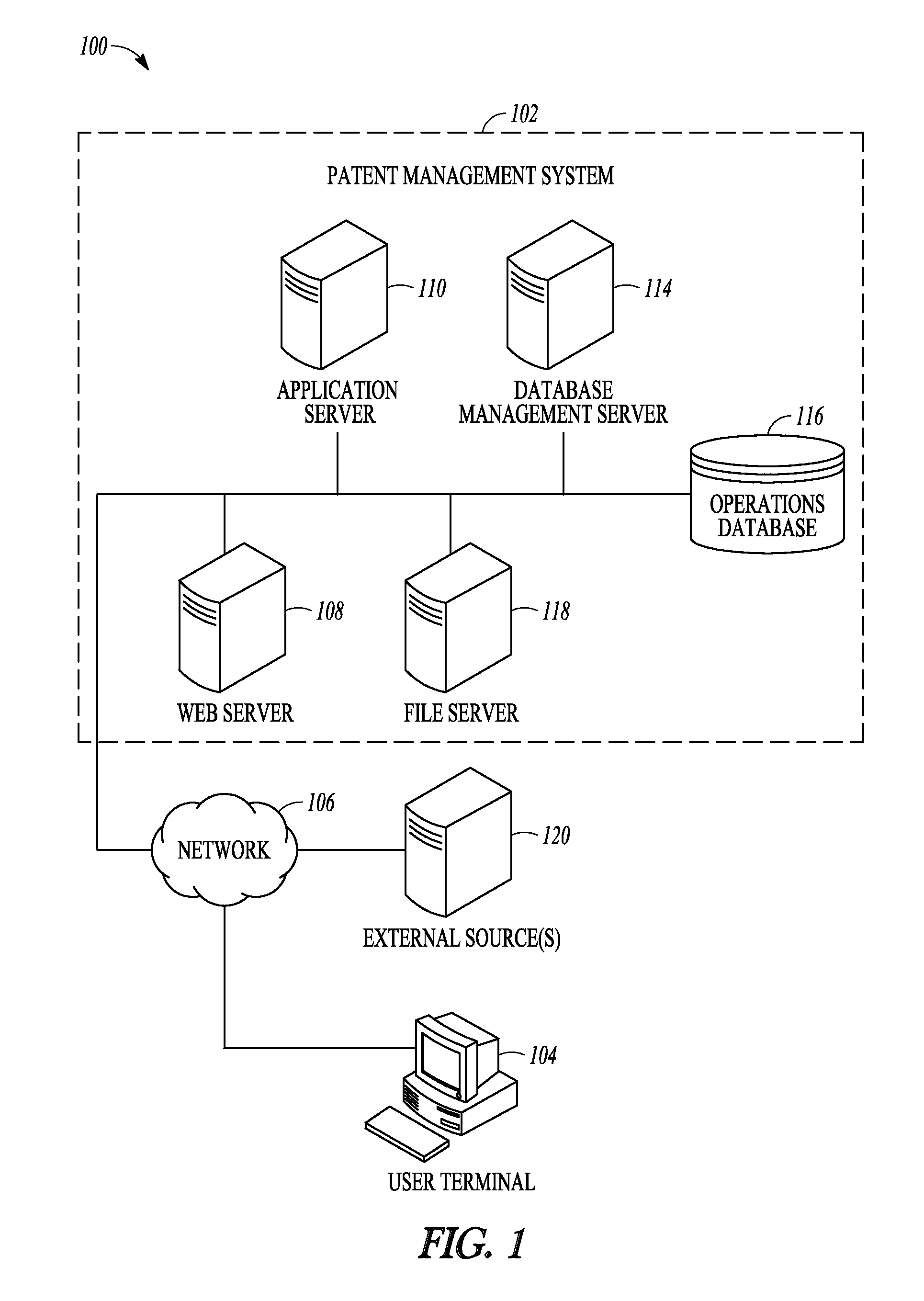

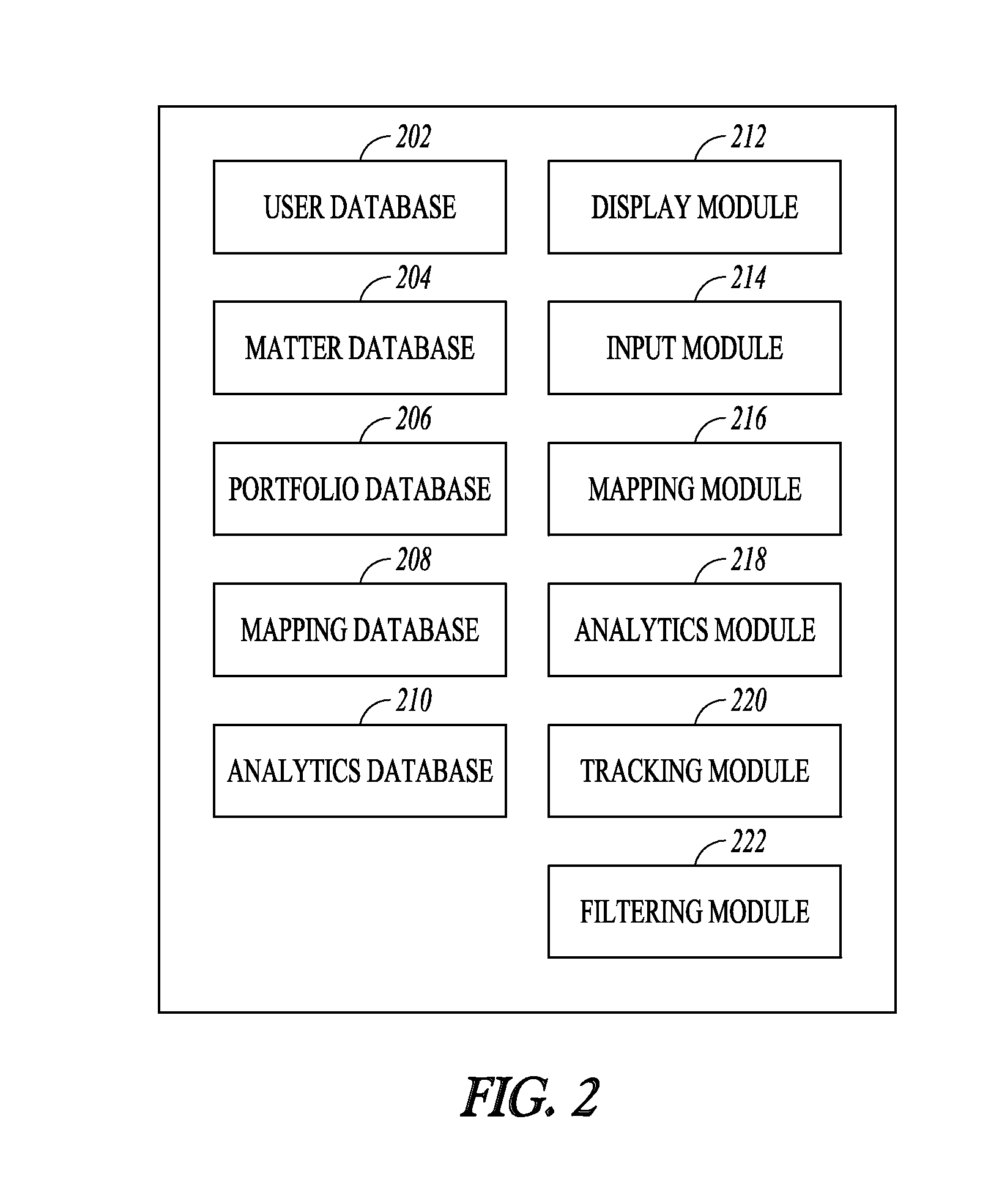

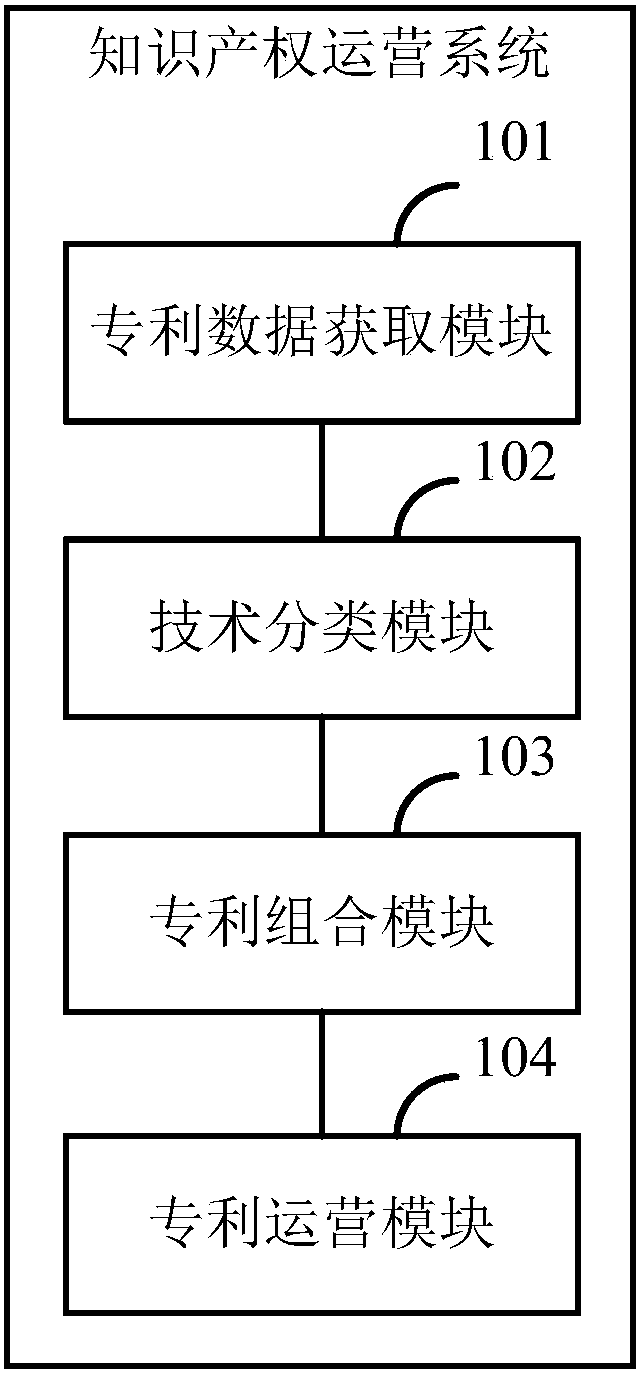

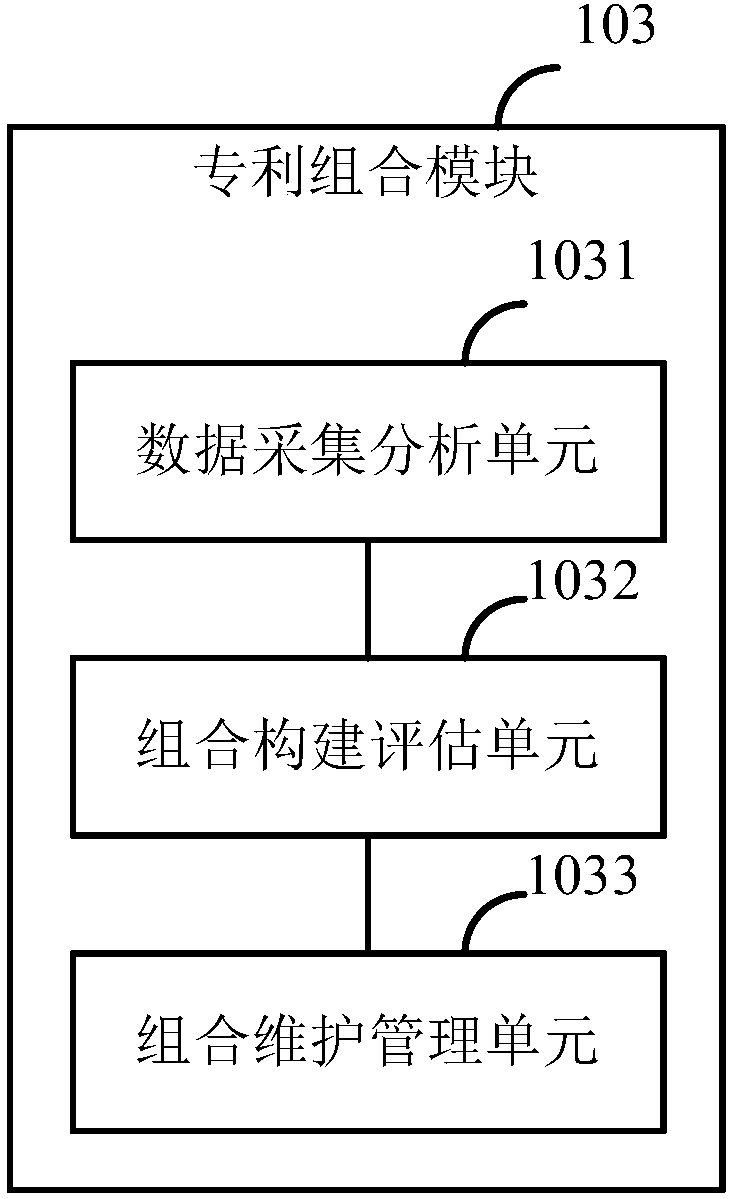

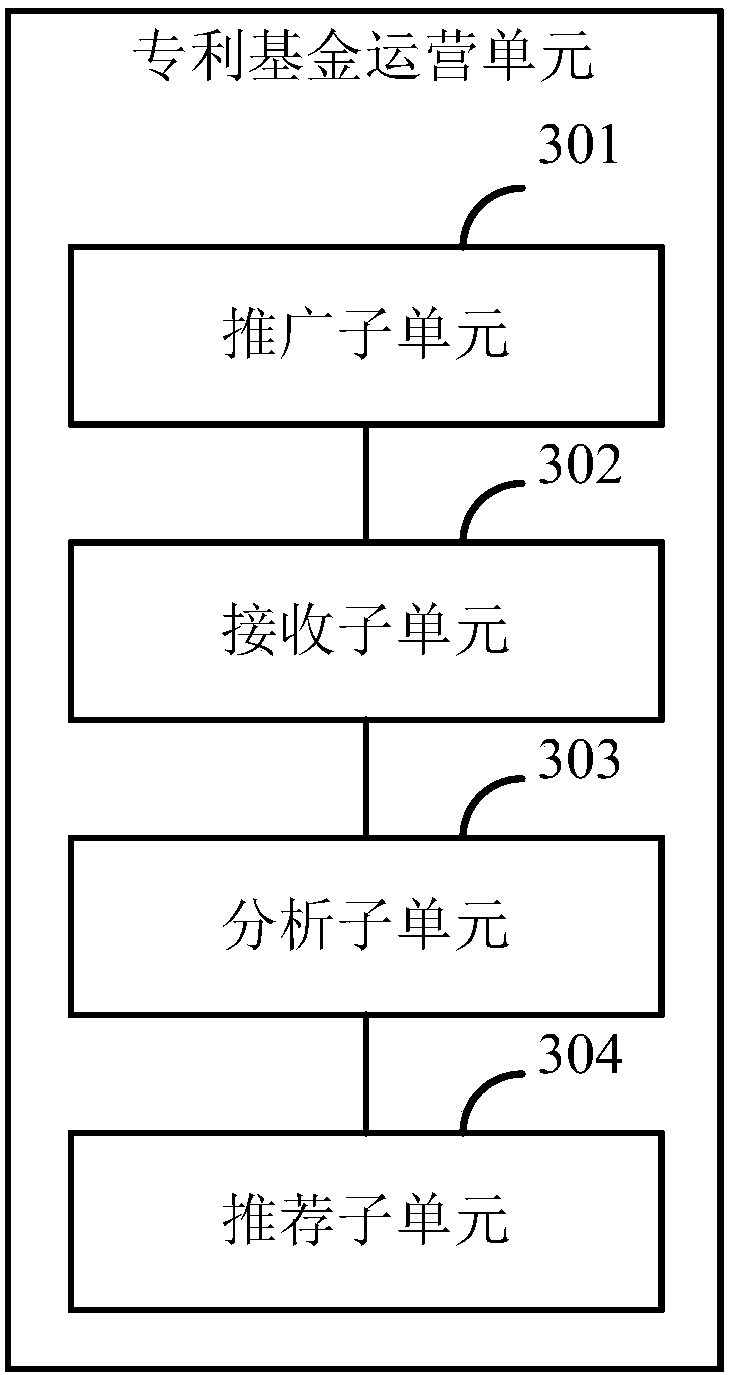

Intellectual property operation system and method

PendingCN107784603AFully unleash innovation abilityImprove international competitivenessData processing applicationsCollection analysisBusiness enterprise

The application provides an intellectual property operation system and method; the system comprises the following units: a patent data acquisition module used for obtaining enterprise patent data; a technology classification module used for dividing technical fields for the enterprise patents according to preset classification strategies; a patent portfolio module used for gathering, analyzing, evaluating and building patent portfolios for the data after technology classification; a patent operation module used for operating said patent portfolios according to preset operation strategies. Themethod builds the intellectual property layout protection and operation work system for the enterprises, thus effectively improving the enterprise international competitiveness and influences.

Owner:STATE GRID INFORMATION & TELECOMM BRANCH +3

System and method for patent portfolio evaluation

InactiveUS7840460B2Improve productivityFriendly interfaceFinanceCommerceLighting spectrumColor-coding

Methods and systems for forming a team of experts and evaluating a portfolio of patent documents have been provided. The methods comprise the step of determining a bias of an expert, and then providing evaluations of patent documents assigned to the expert according to a selected evaluation method, which is bias corrected to reduce or compensate for the bias of the expert. A system for evaluating a patent portfolio comprises means for assigning the patent documents to said experts and monitoring progress of the evaluation process of each expert, and means for performing evaluations of the assigned patent documents by each expert. The system is further enhanced with the means for determining the bias of the expert, and with a visualization unit for visualizing the results of the patent portfolio evaluation by color coding the evaluation results, wherein patent documents having different values are represented by different colors of a visible part of the light spectrum. A corresponding computer program product, a computer memory and a web site for providing access to the system and management of activities of the experts are also described.

Owner:WILLIAMS ALLAN

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com