Patents

Literature

59 results about "Card not present" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

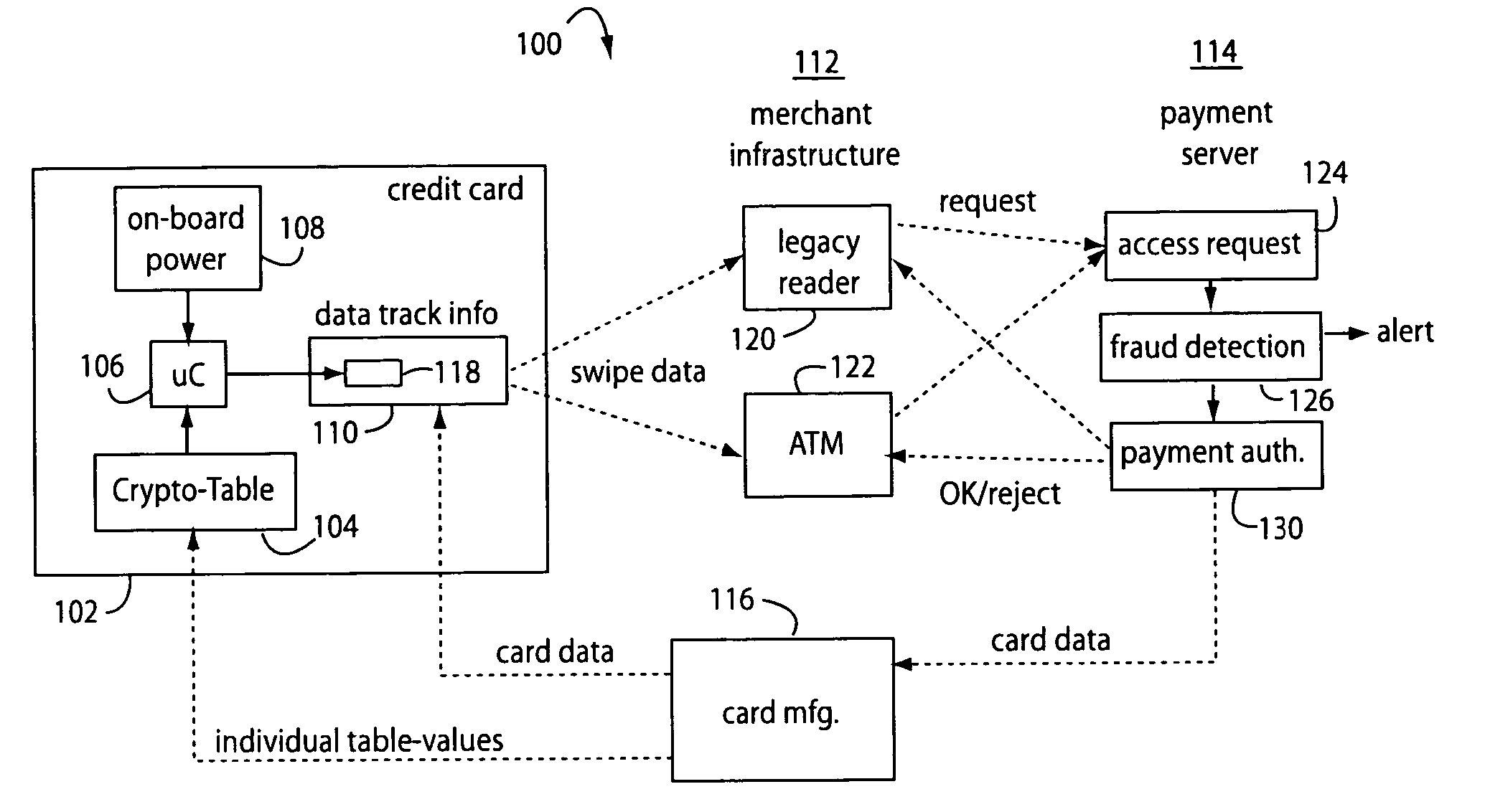

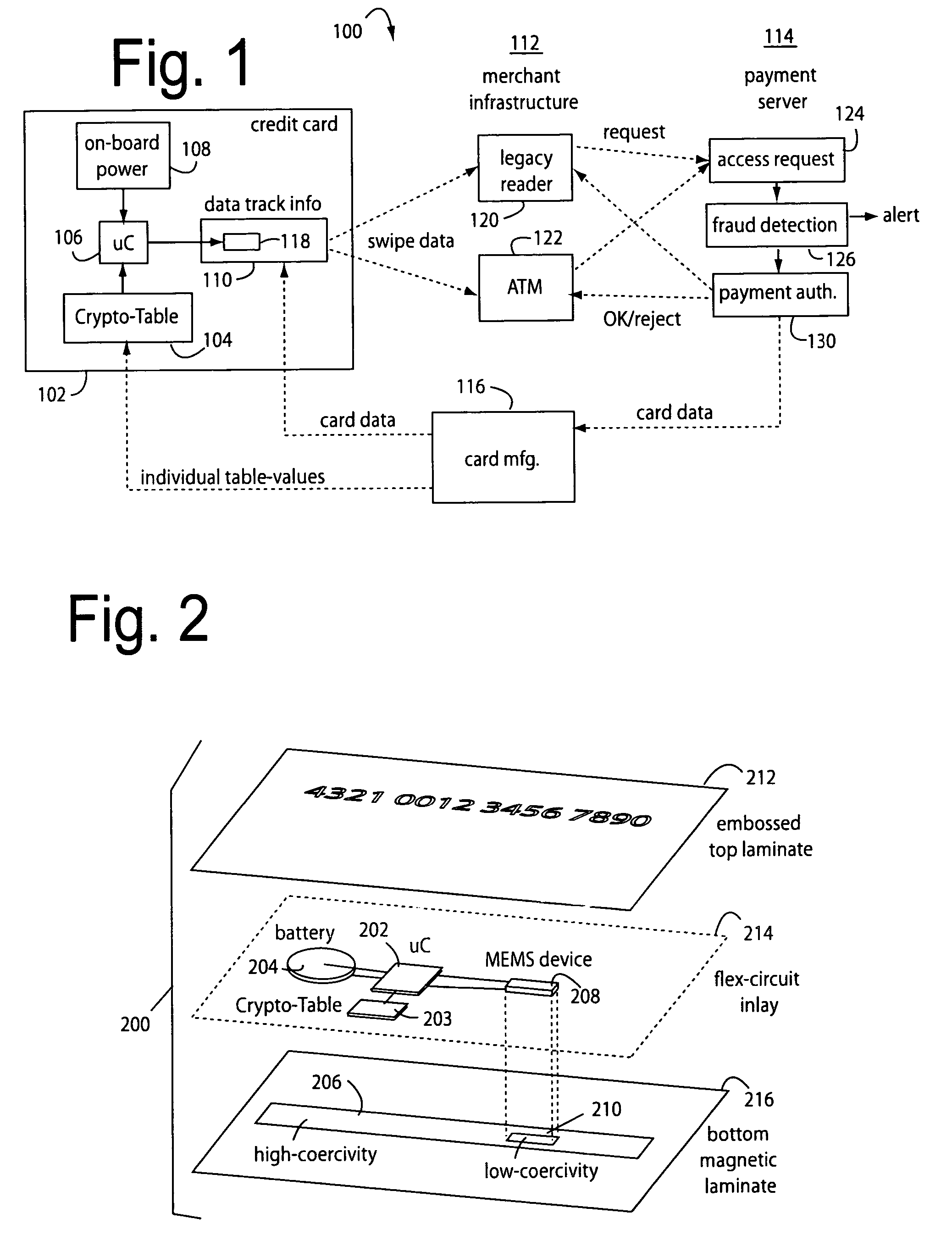

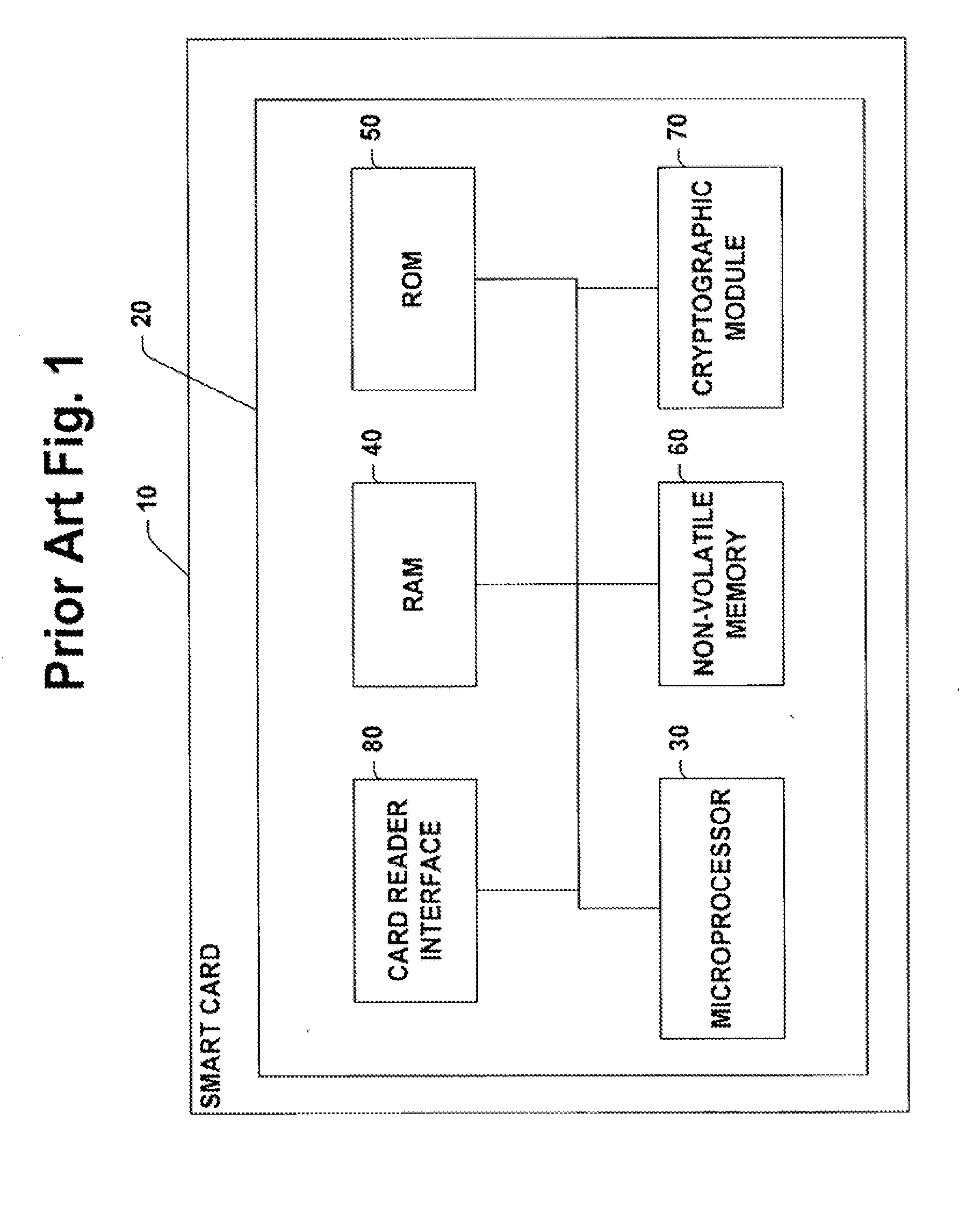

Financial transactions with dynamic card verification values

ActiveUS7584153B2Sufficient dataComputer security arrangementsPayment architectureUser needsDisplay device

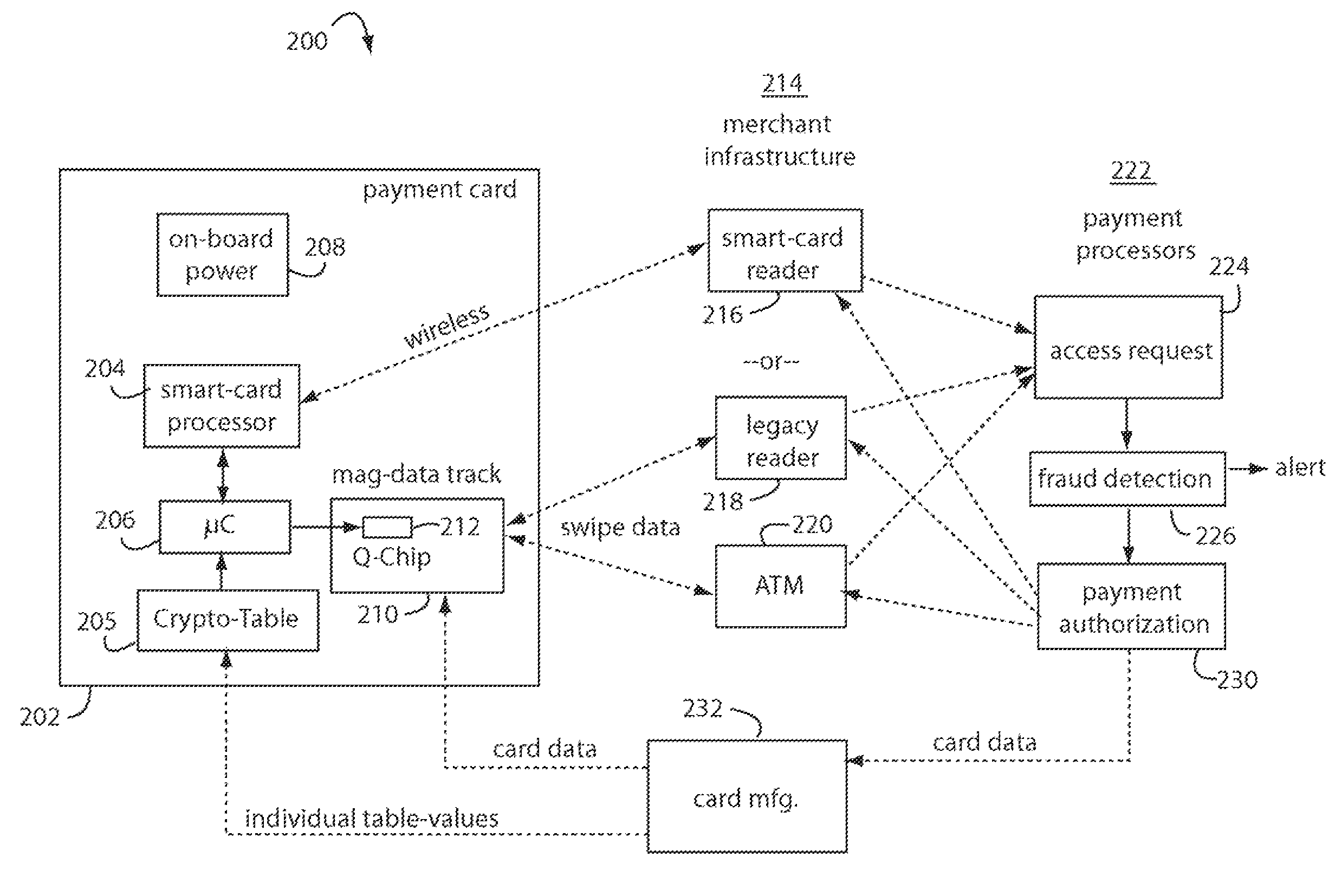

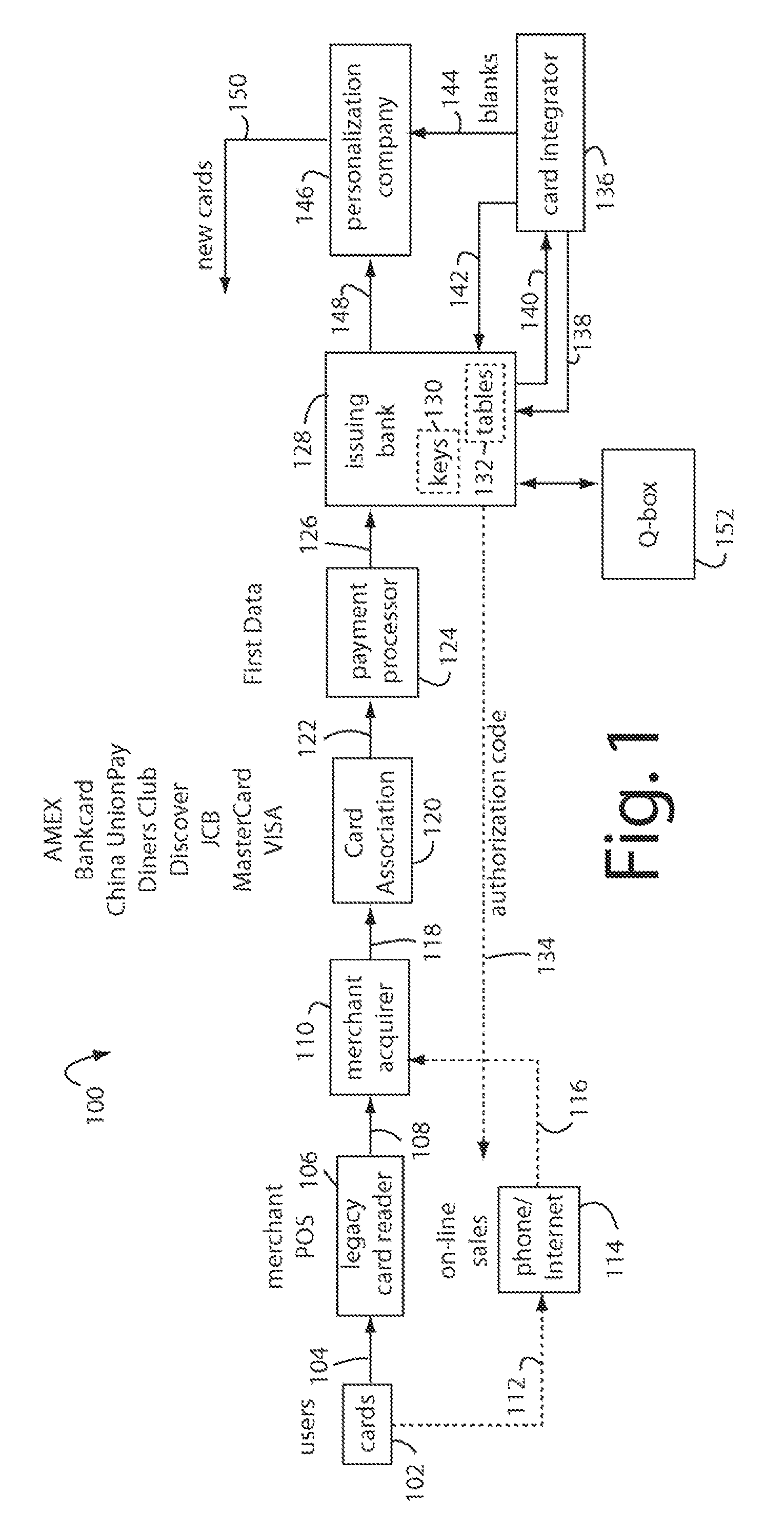

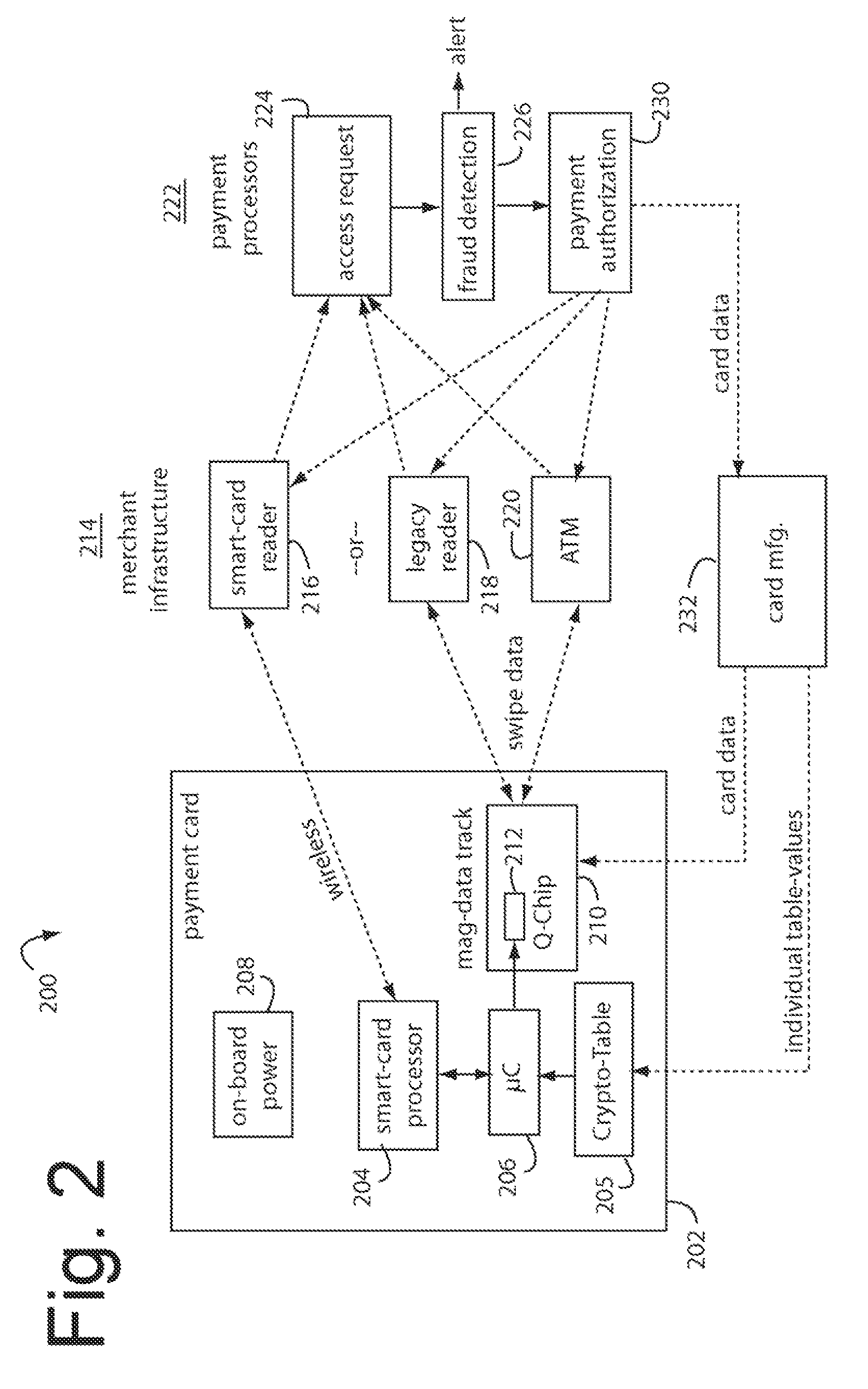

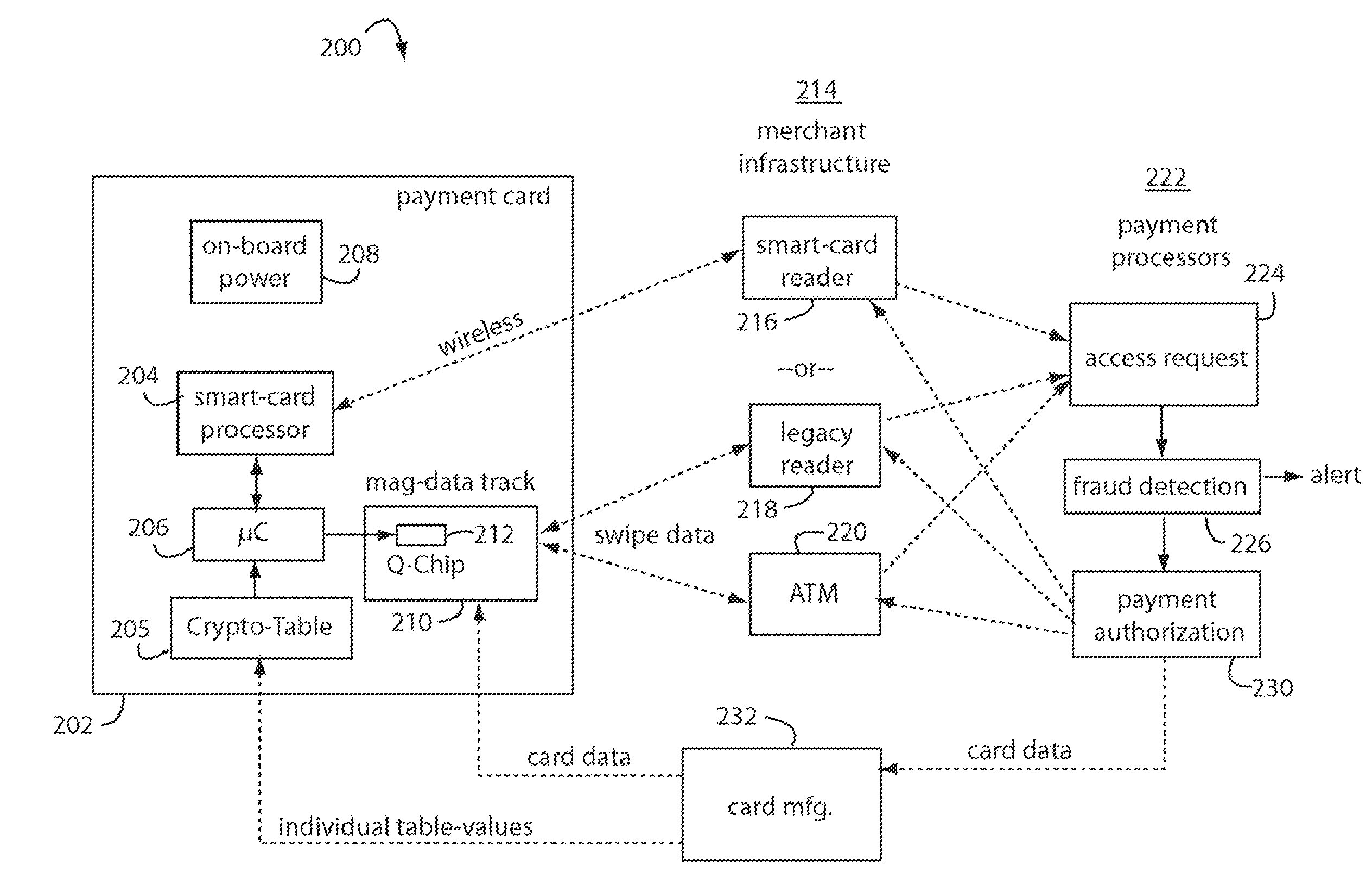

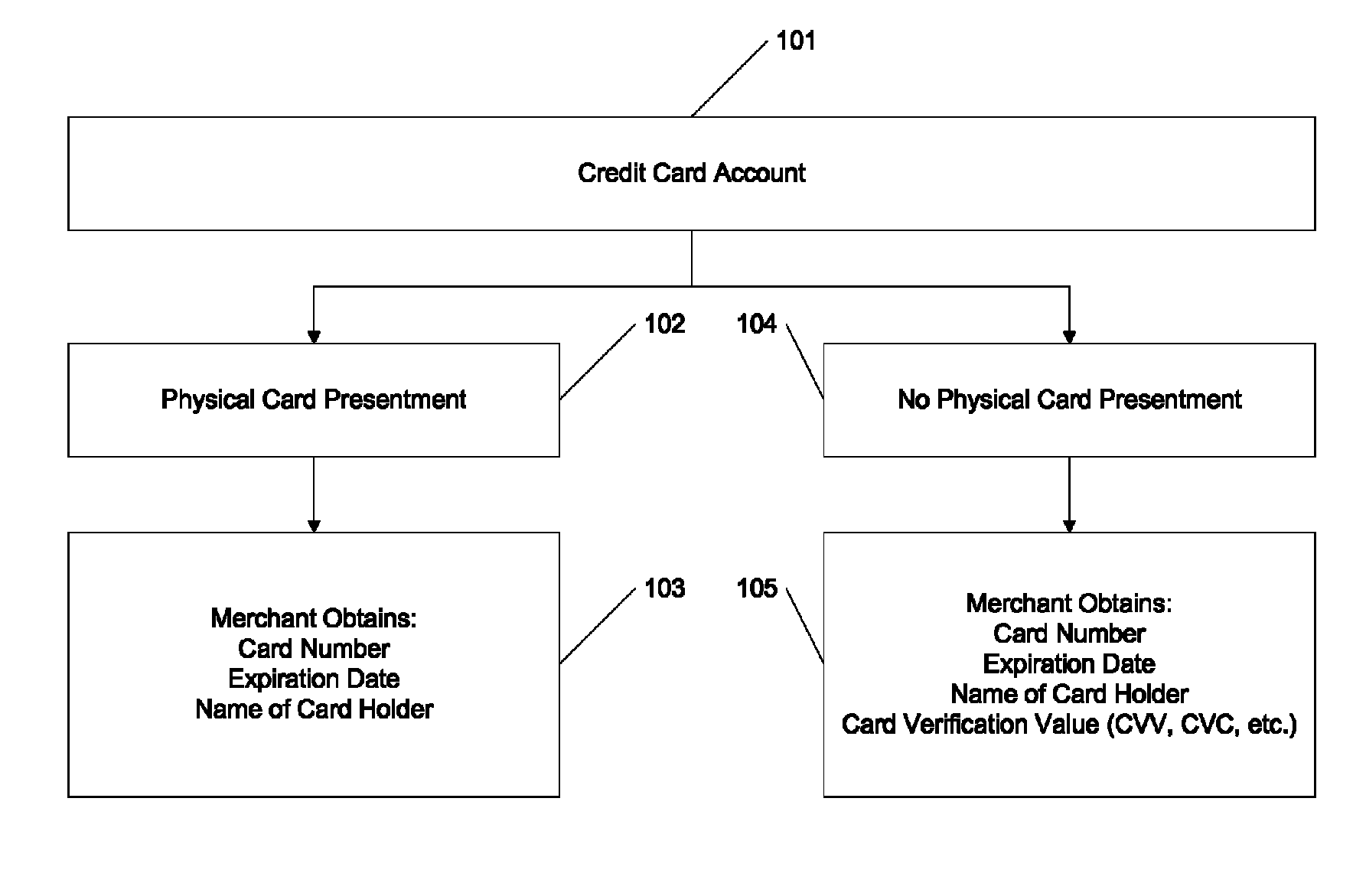

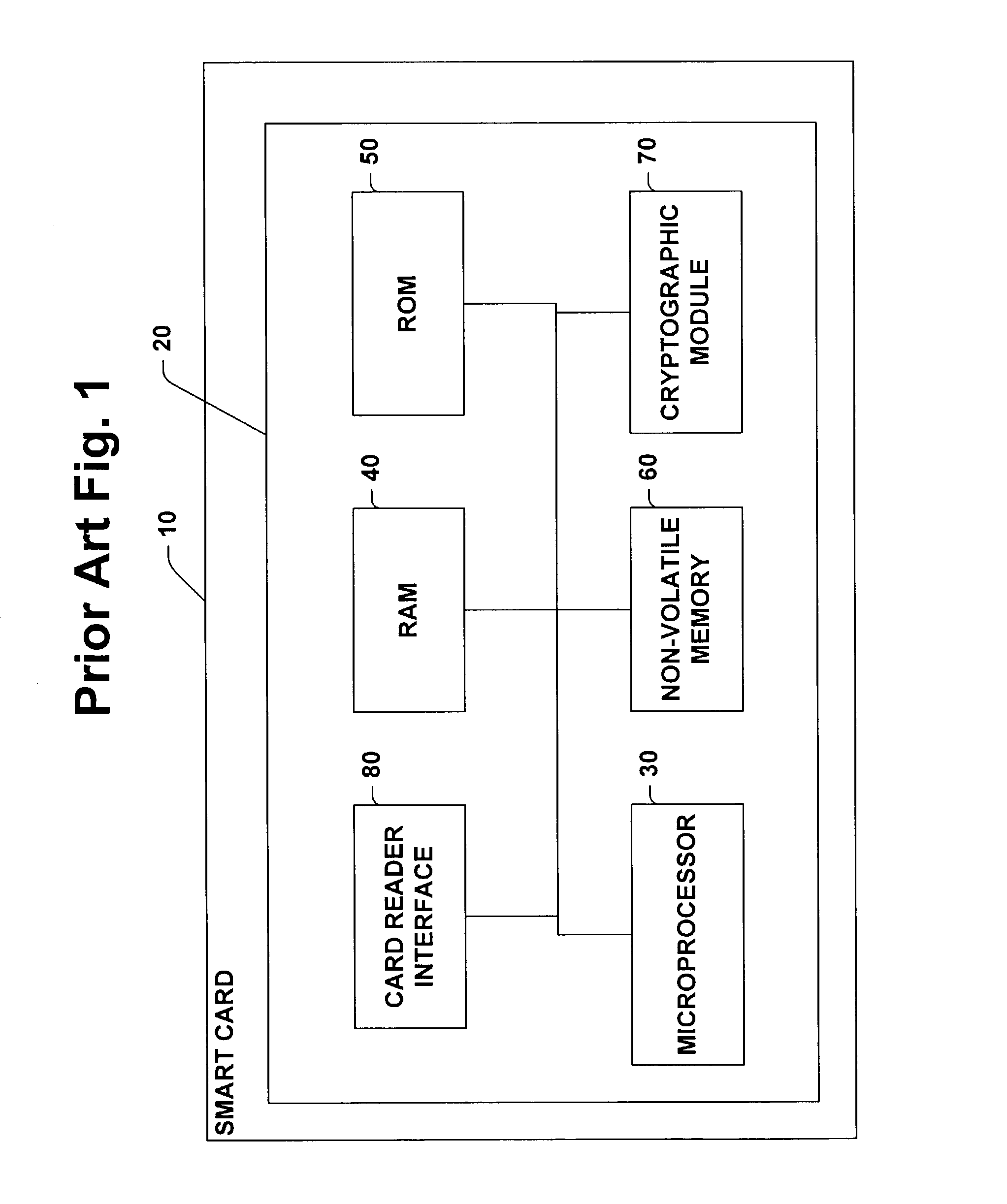

A payment card comprises an internal dynamic card verification value (CVV) generator and a user display for card-not-present transactions. Card-present transactions with merchant card readers are enabled by a dynamic magnetic array internally associated with the card's magnetic stripe. The user display and a timer are triggered by the user when the user needs to see the card verification value and / or begin a new transaction. A new card verification value is provided for each new transaction according to a cryptographic process, but the timer limits how soon a next new card verification value can be generated.

Owner:FITBIT INC

Financial transactions with dynamic card verification values

ActiveUS20070136211A1Sufficient dataComputer security arrangementsPayment architectureUser needsPower user

A payment card comprises an internal dynamic card verification value (CVV) generator and a user display for card-not-present transactions. Card-present transactions with merchant card readers are enabled by a dynamic magnetic array internally associated with the card's magnetic stripe. The user display and a timer are triggered by the suer when the user needs to see the card verification value and / or begin a new transaction. A new card verification value is provided for each new transaction according to a cryptographic process, but the timer limits how soon a next new card verification value can be generated.

Owner:FITBIT INC

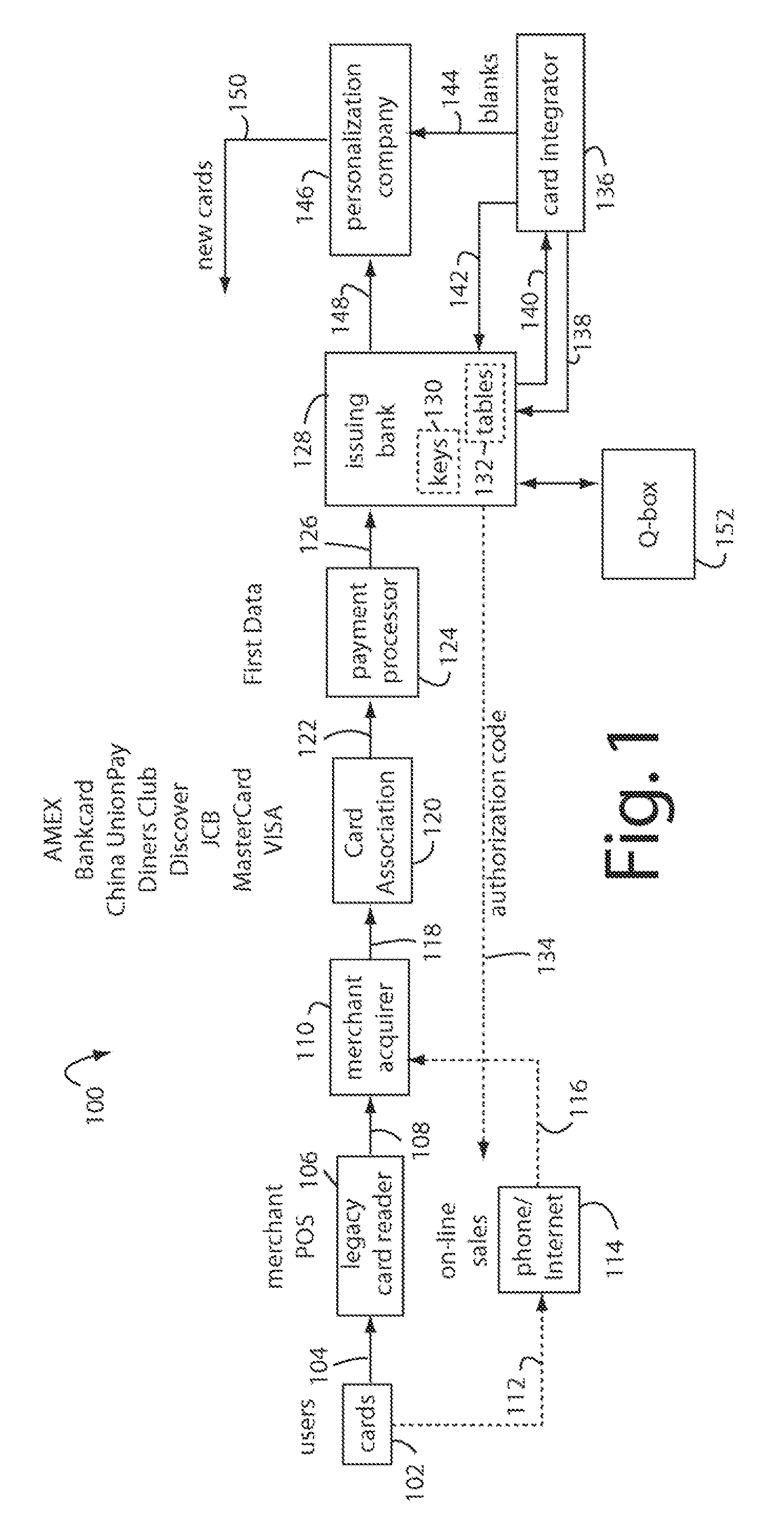

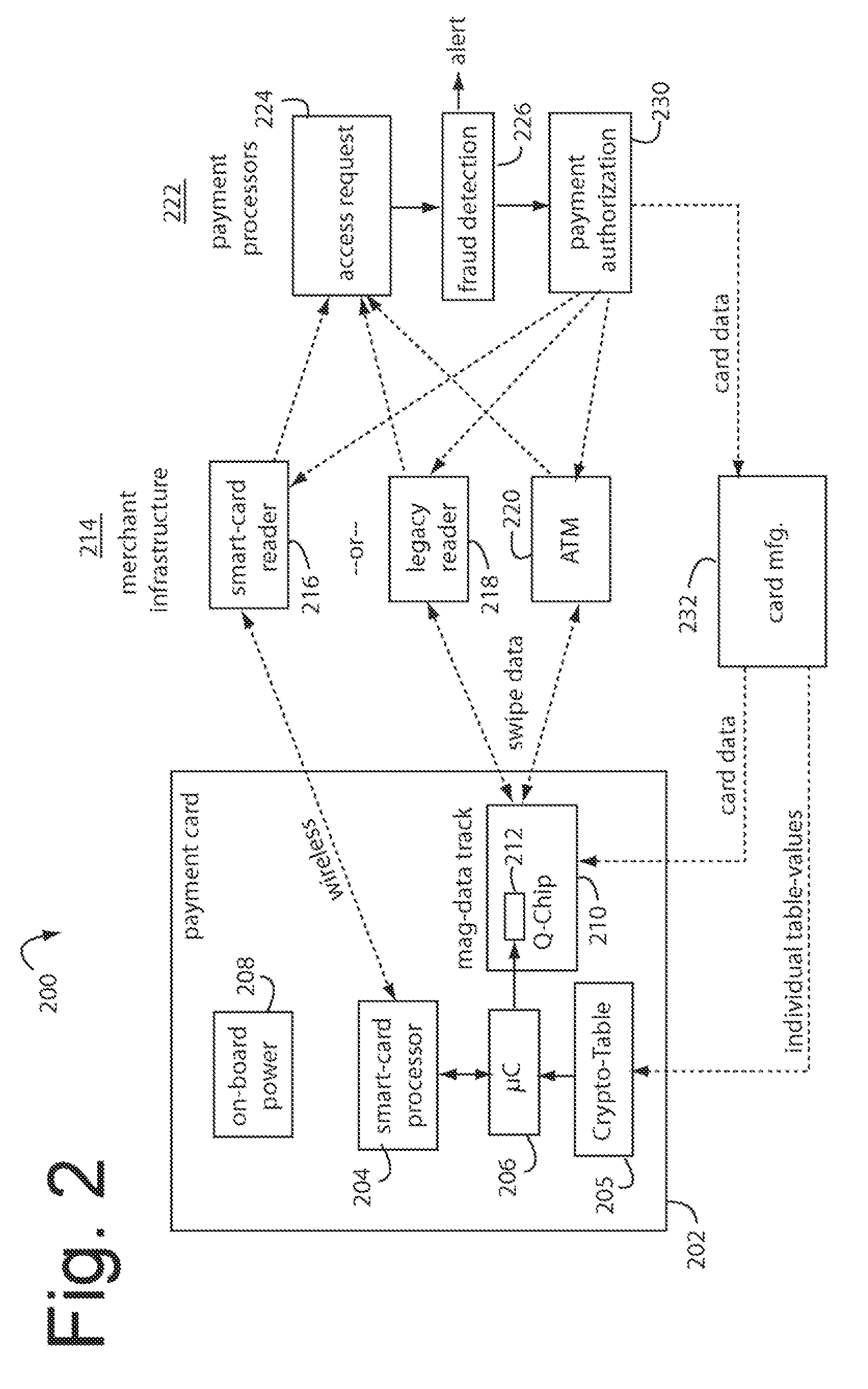

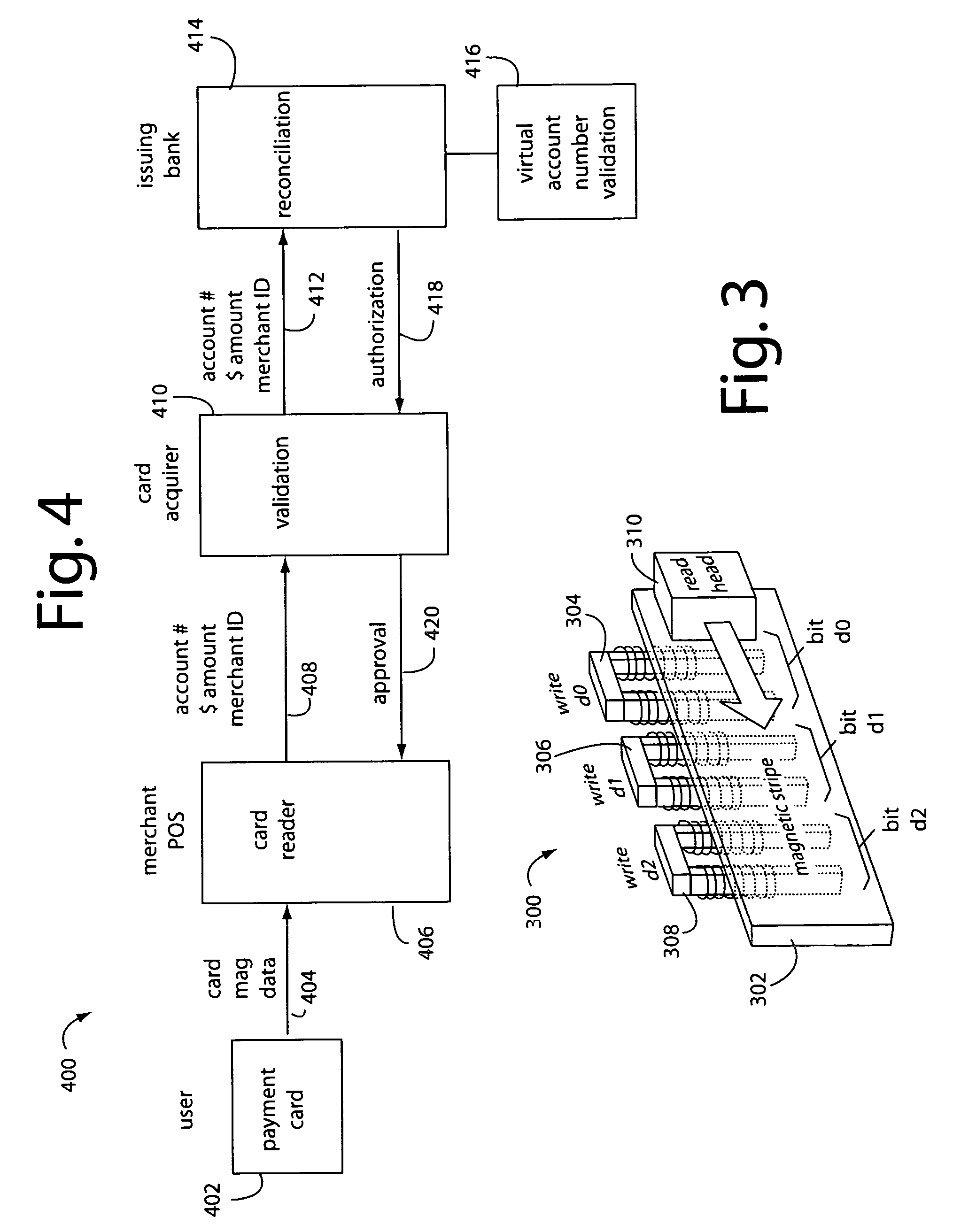

Automated payment card fraud detection and location

A payment card fraud detection business model comprises an internal virtual account number generator and a user display for Card-Not-Present transactions. Card-Present transactions with merchant card readers are enabled by a magnetic array internally associated with the card's magnetic stripe. The internal virtual account number generator is able to reprogram some of the magnetic bits encoded in the magnetic stripe to reflect the latest virtual account number. The internal virtual account number generator produces a sequence of virtual numbers that can be predicted and approved by the issuing bank. Once a number is used, such is discarded and put on an exclusion list or reserved for a specific merchant until the expiration date. A server for the issuing bank logs the merchant locations associated with each use or attempted use, and provides real-time detection of fraudulent attempts to use a virtual account number on the exclusion list. Law enforcement efforts can then be directed in a timely and useful way not only where the fraud occurs but also at its origination.

Owner:FITBIT INC

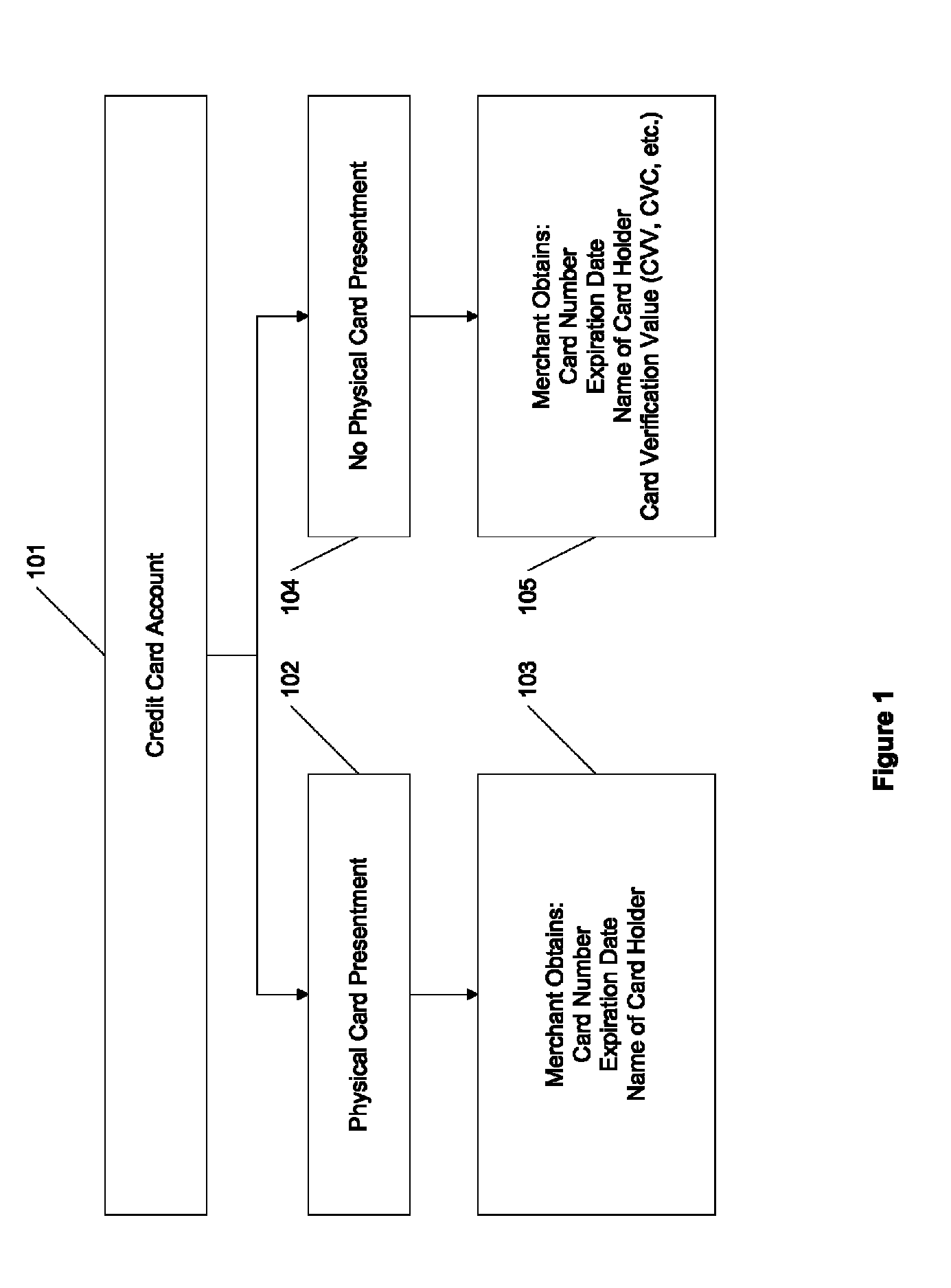

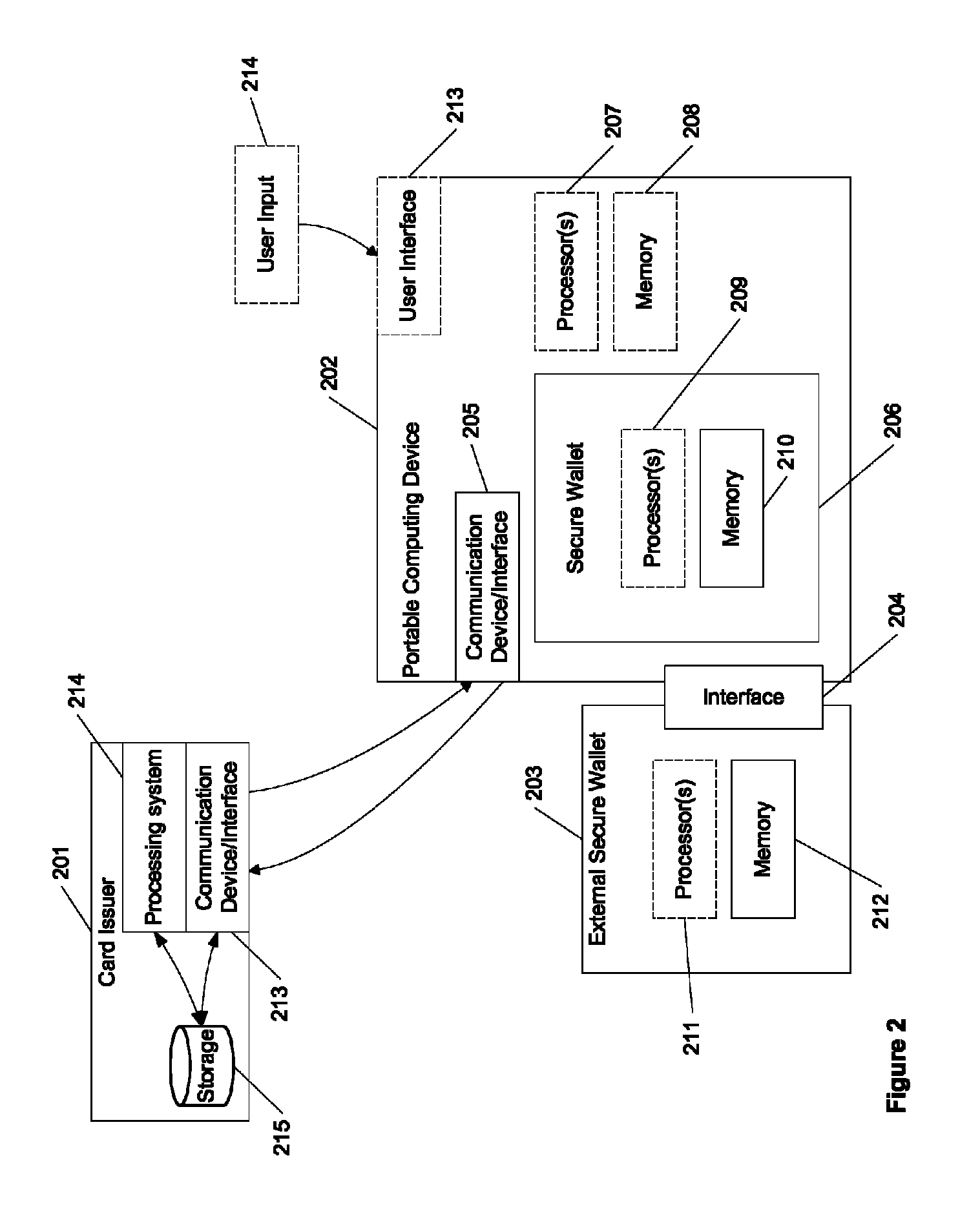

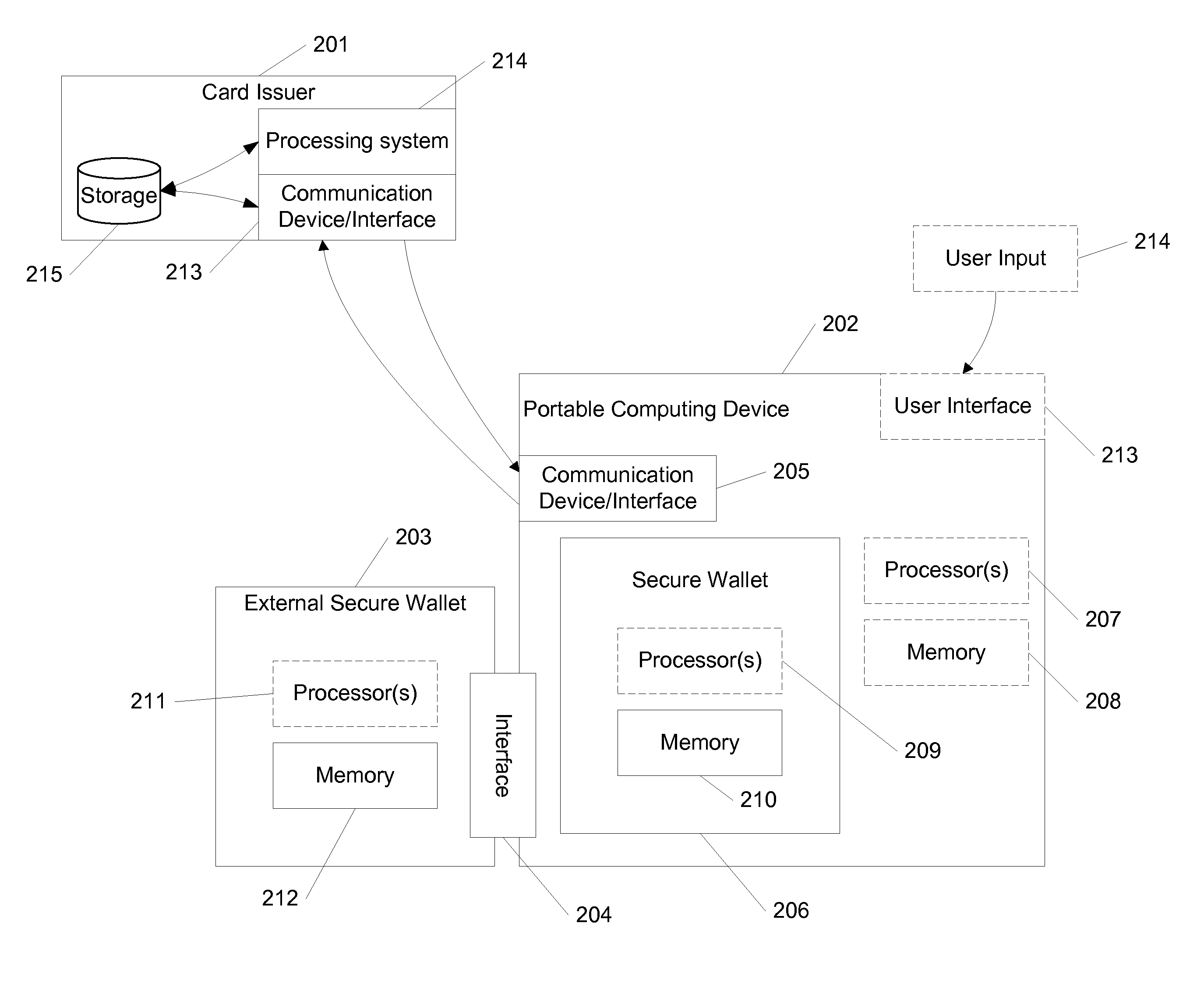

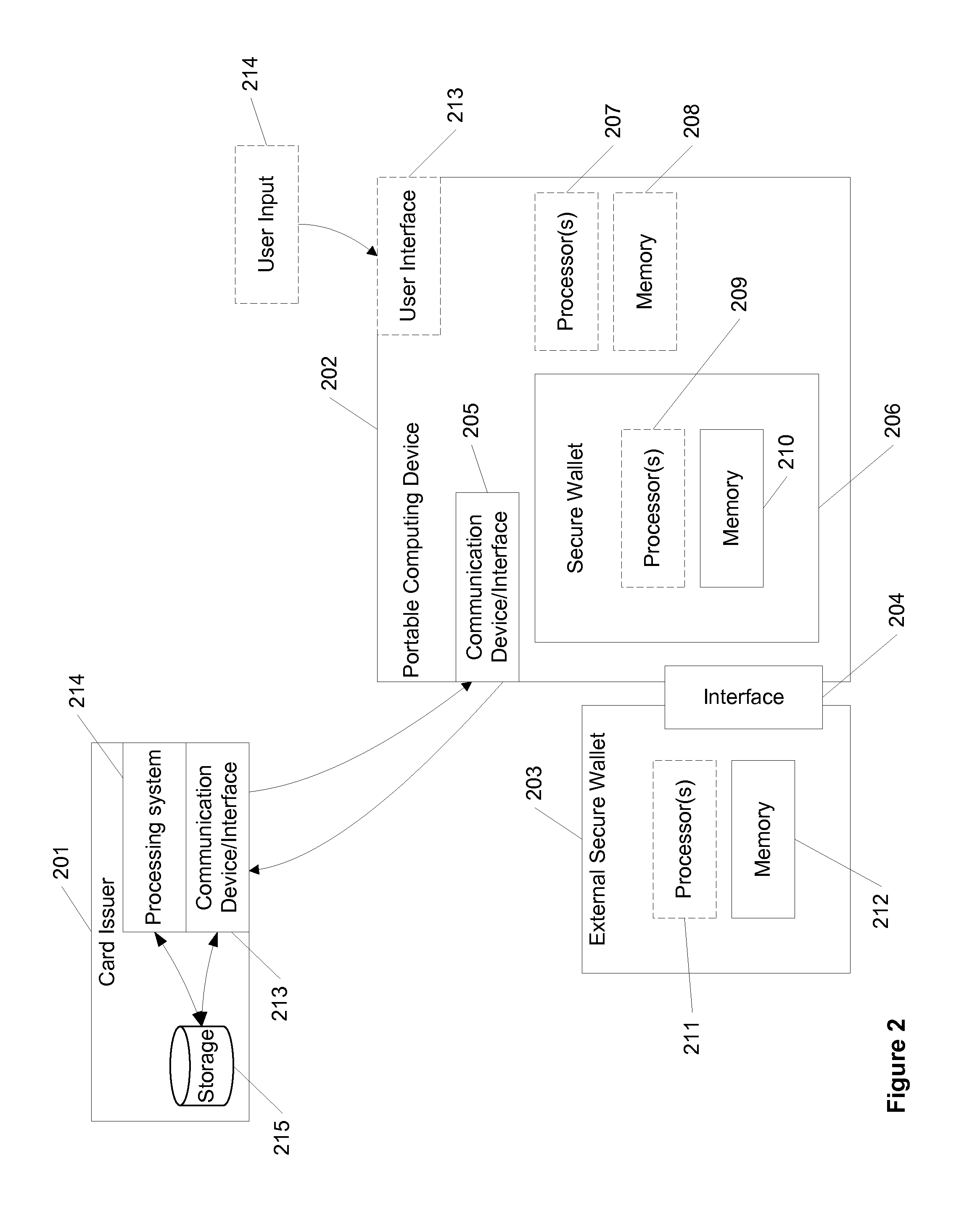

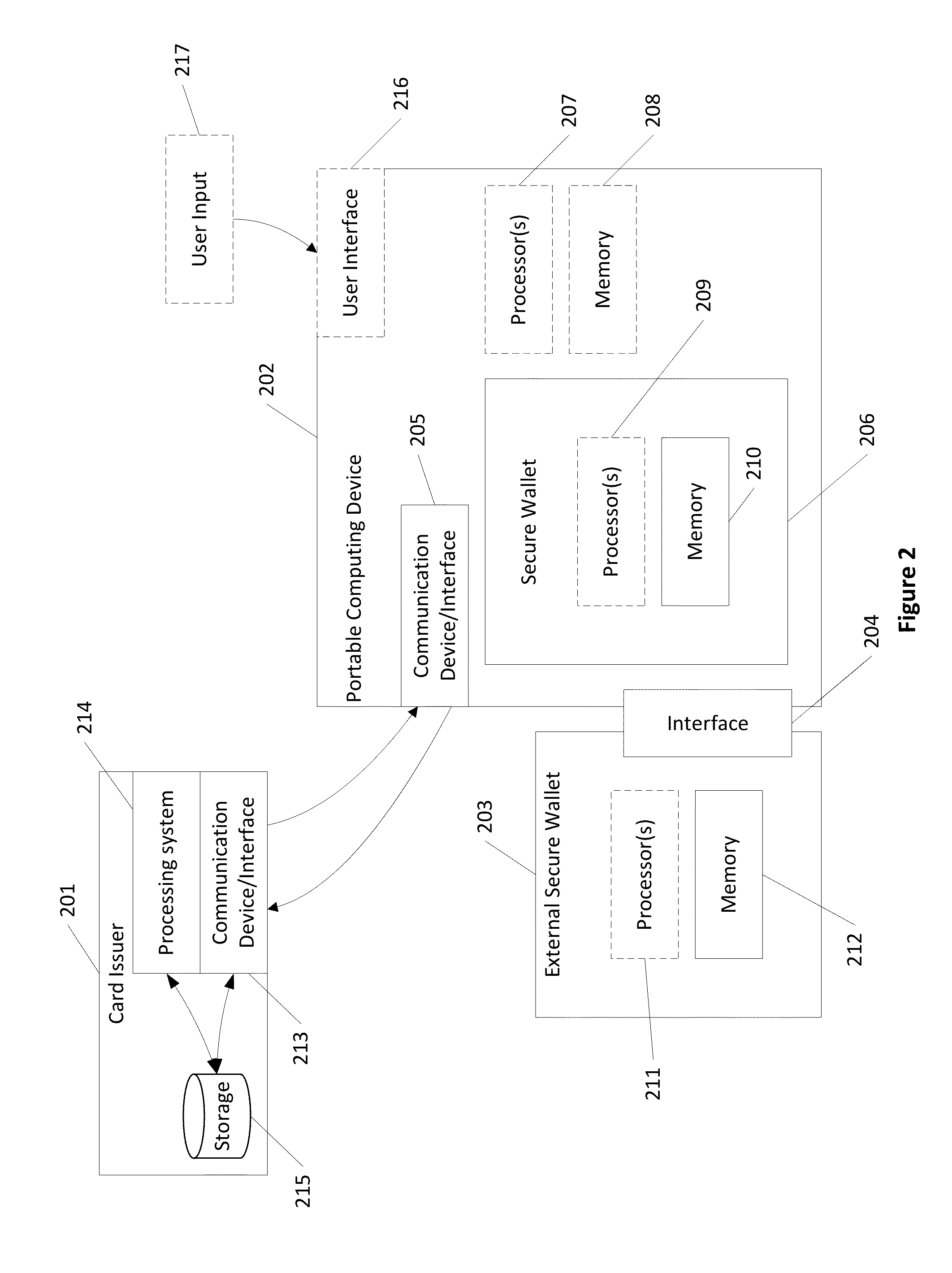

Dynamic card verification values and credit transactions

A system and method for providing card verification values for card-not-present transactions is described. In one example, a user's computing device stores single-use CVVs to be provided from a secure wallet. The secure wallet may be software running on the user's computing device. Alternatively, it may be an external device connectable to the user's computing device, which accesses the external device to obtain the single-use CVV.

Owner:AURA SUB LLC +1

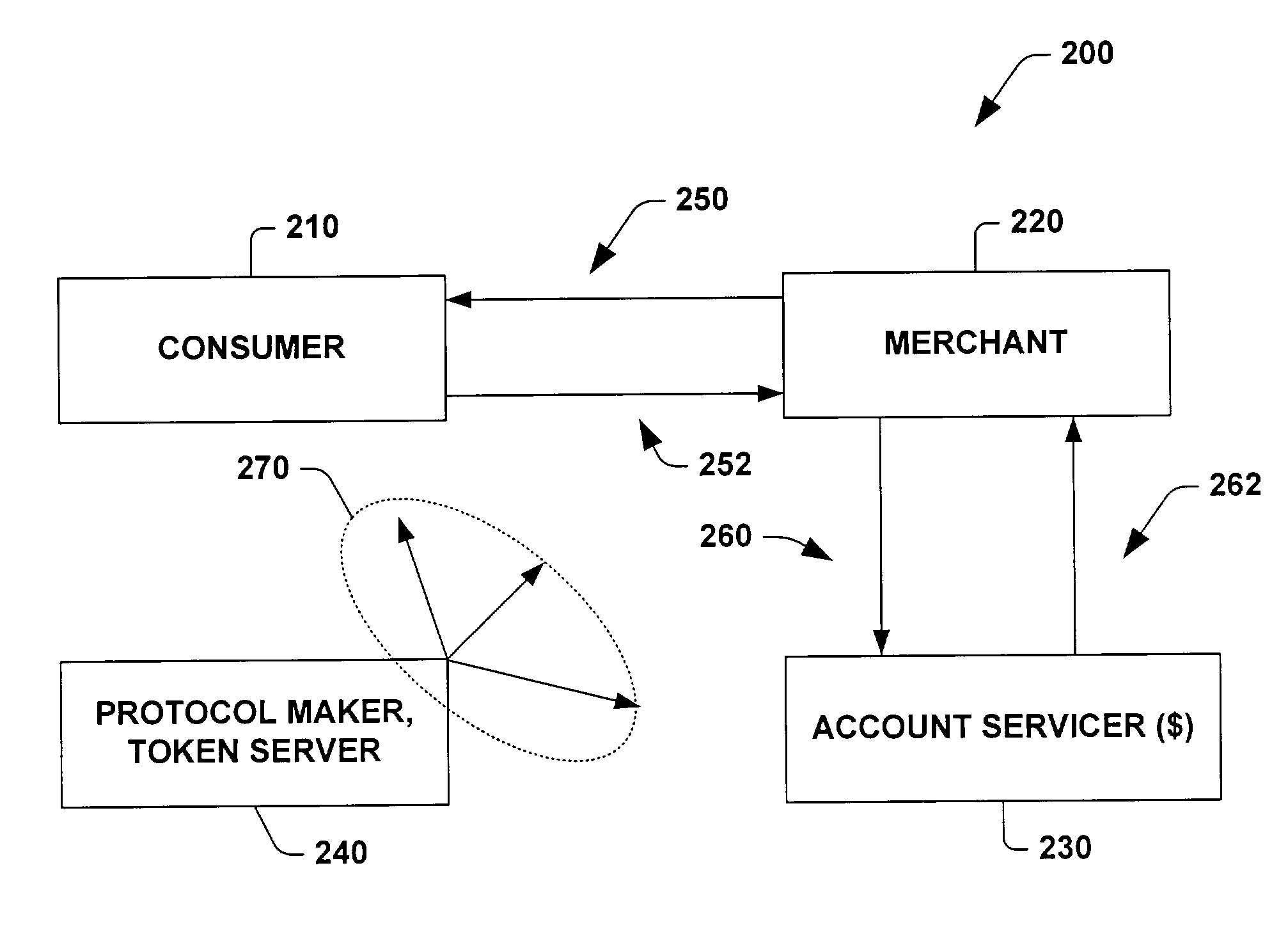

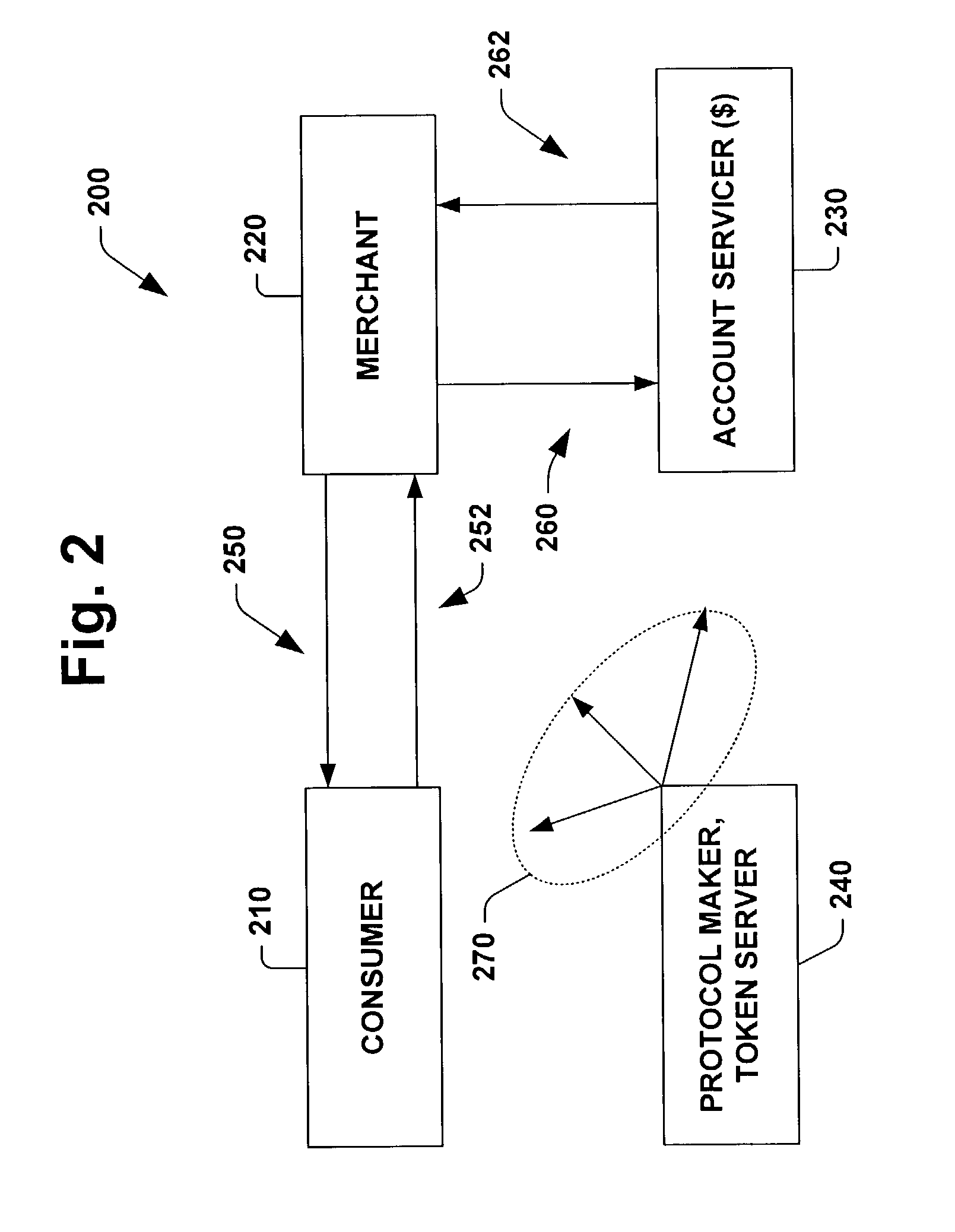

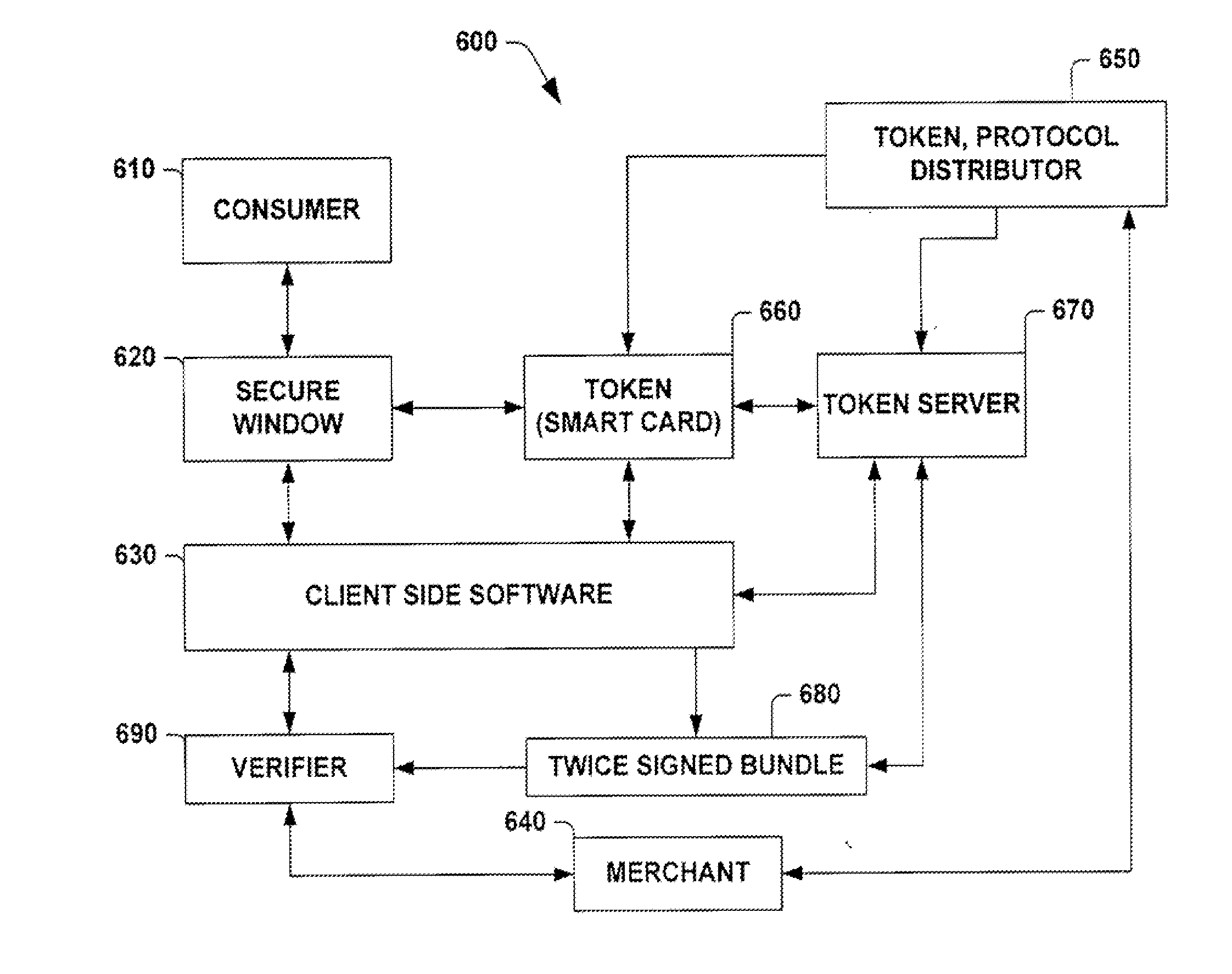

Late binding tokens

ActiveUS8060448B2Easy to createPrecise positioningFinanceMultiple digital computer combinationsClient-sideProtocol for Carrying Authentication for Network Access

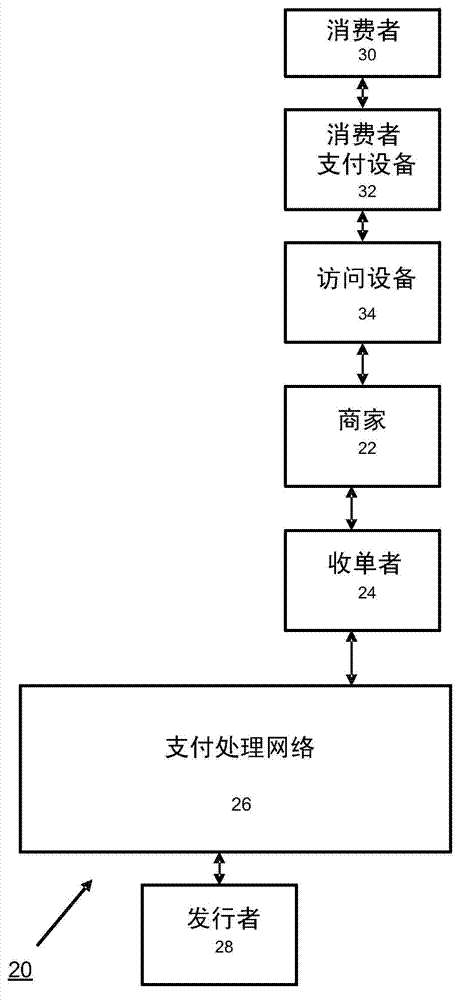

A system for verifying intent in a card not present transaction is provided. The system includes a late binding token that is distributable to consumers without necessarily being bound to an account. The system also includes a client software that locates a token server configured to facilitate managing and communicating with the late binding token. The system also includes a protocol concerning how to build a verifiably secure structured proposal that carries an offer to the consumer through the client software.

Owner:JONES THOMAS C

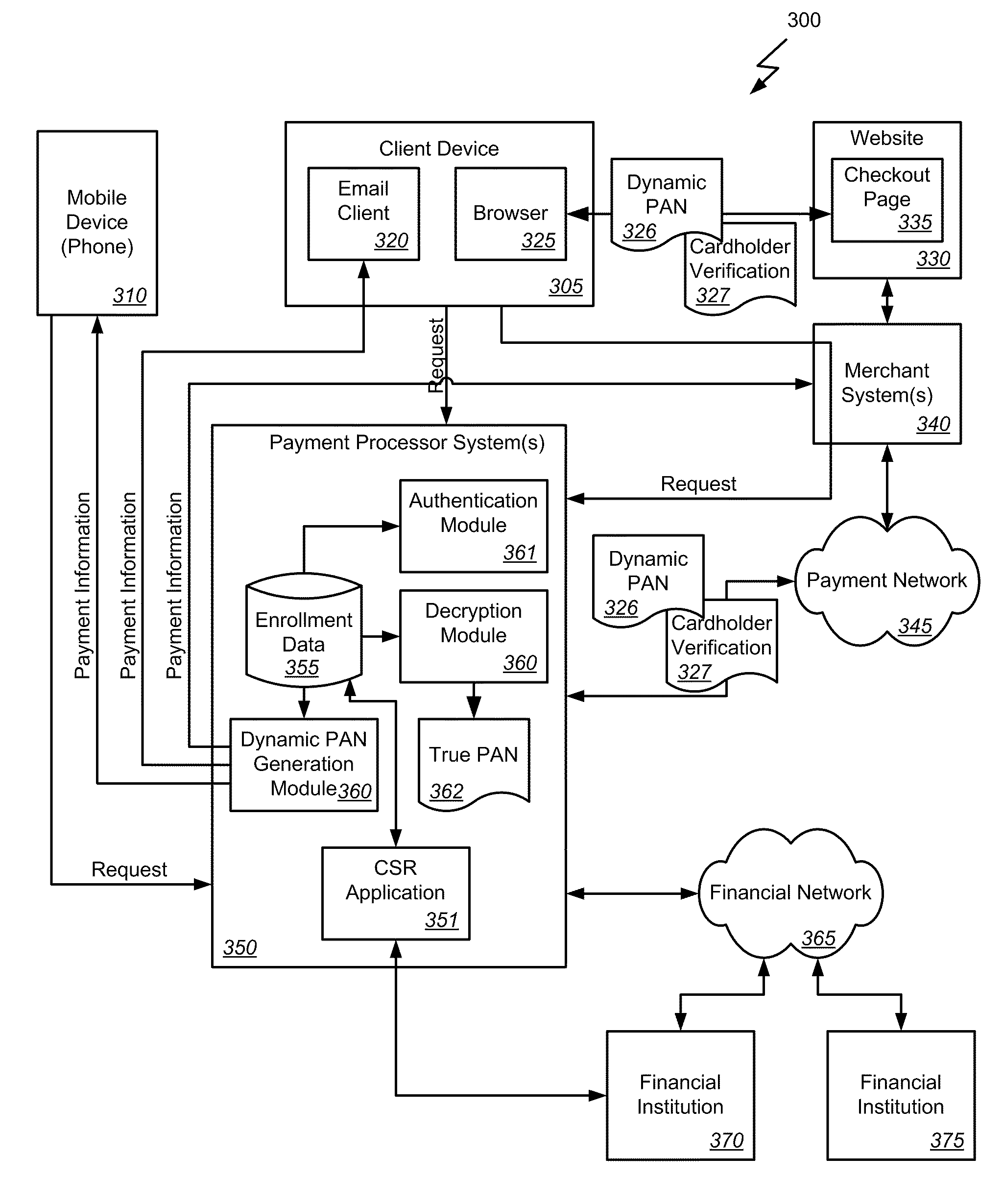

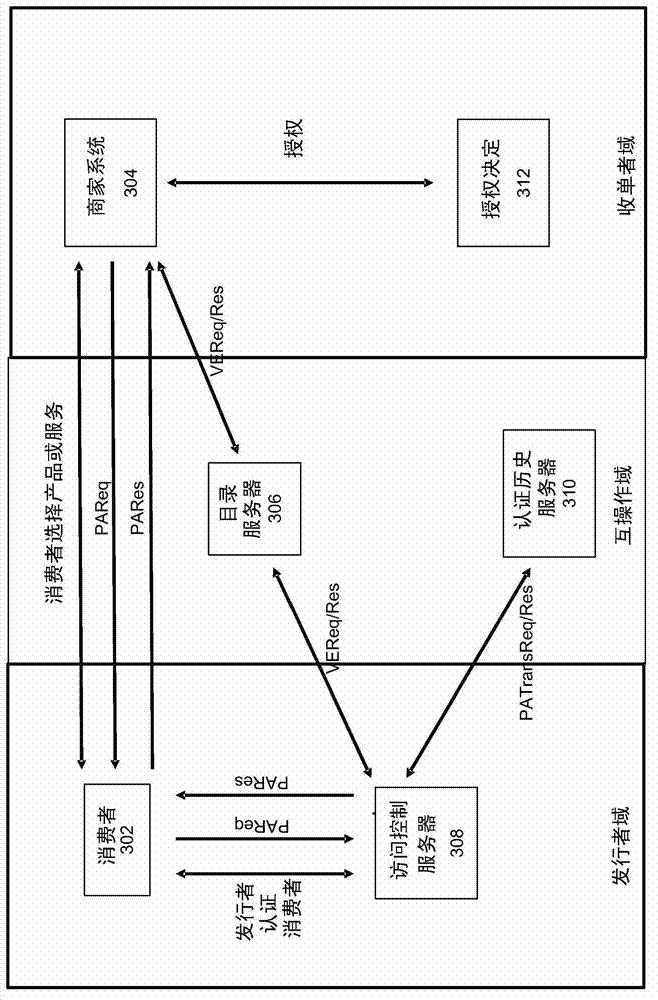

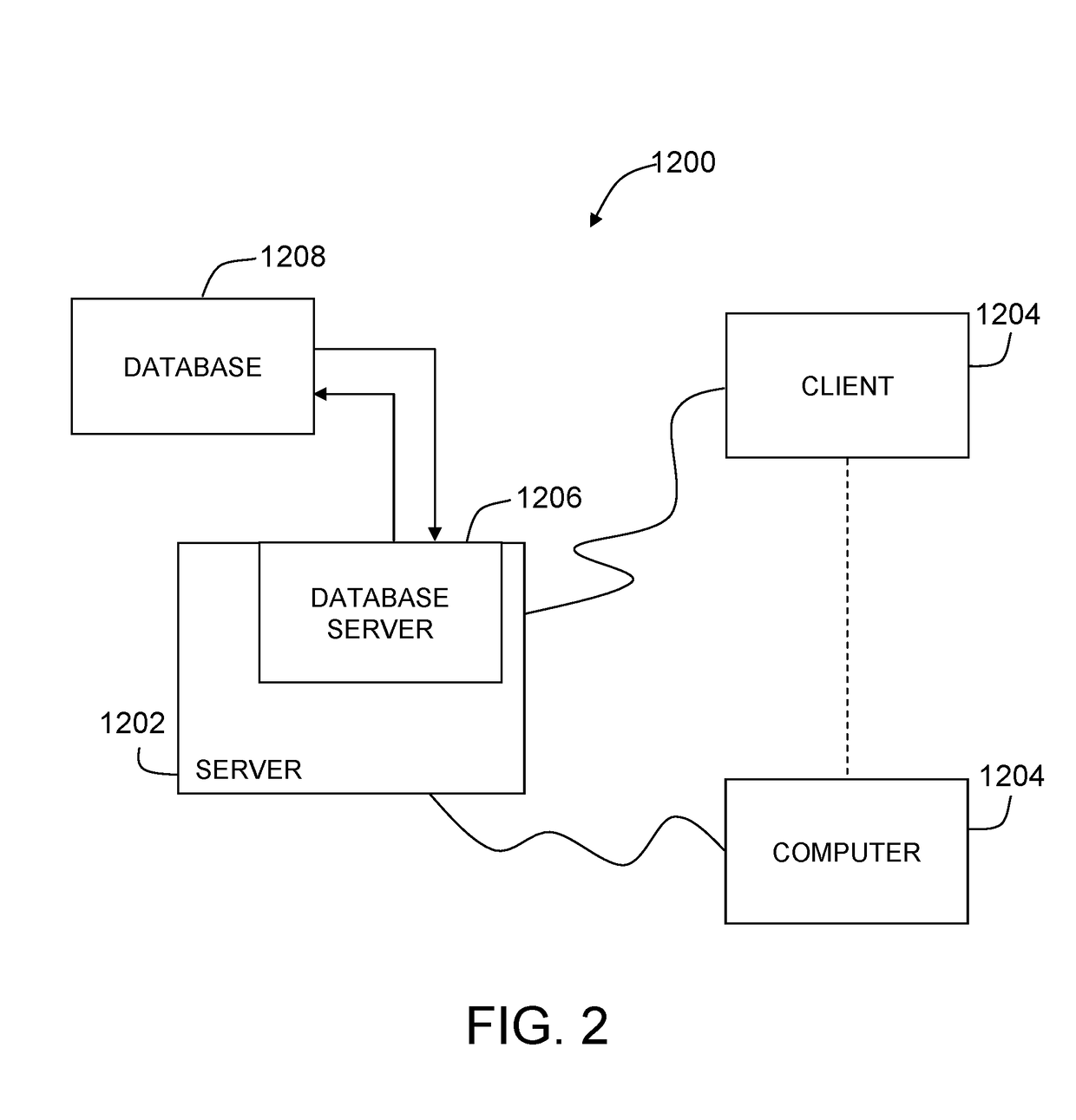

Authentication of card-not-present transactions

ActiveUS20110153496A1Avoid exposureAvoid lossFinanceMultiple digital computer combinationsOne-time passwordDatabase

Methods, systems, and machine-readable media are disclosed for processing a card-not-present transaction. According to one embodiment, processing a card-not-present transaction can comprise receiving a request for a card-not-present transaction involving an enrolled consumer. The request can include information identifying the enrolled consumer. A record of information related to the enrolled consumer can be read and the enrolled consumer can be authenticated based at least in part on the information of the request and the record of information related to the enrolled consumer. In response to authenticating the enrolled consumer, a set of single-use payment information can be generated which can include a one-time password and a dynamic Primary Account Number (PAN) which is valid for a single transaction. The single-use payment information can be provided to the enrolled consumer or the merchant to complete the transaction in place of the true PAN.

Owner:FIRST DATA

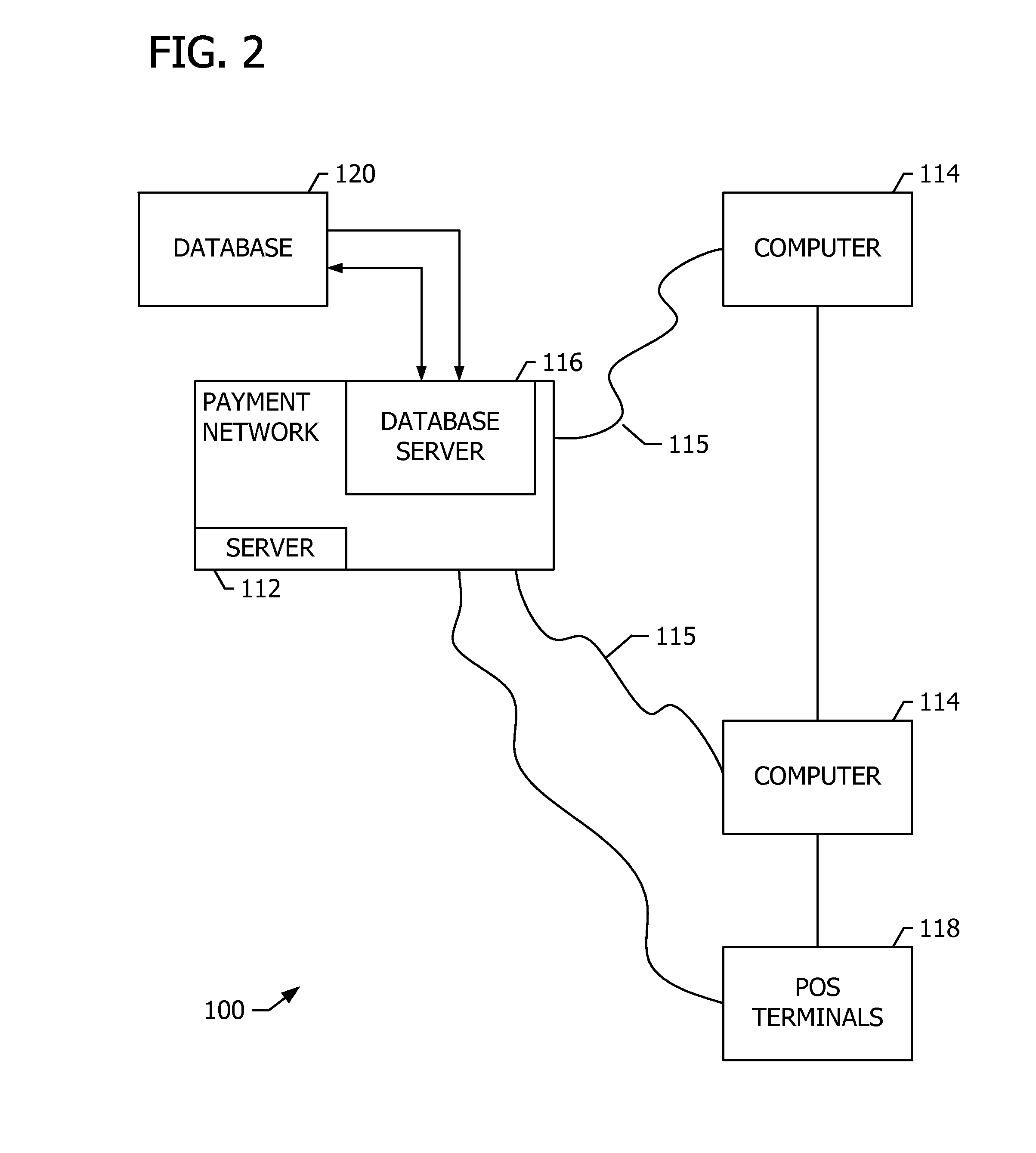

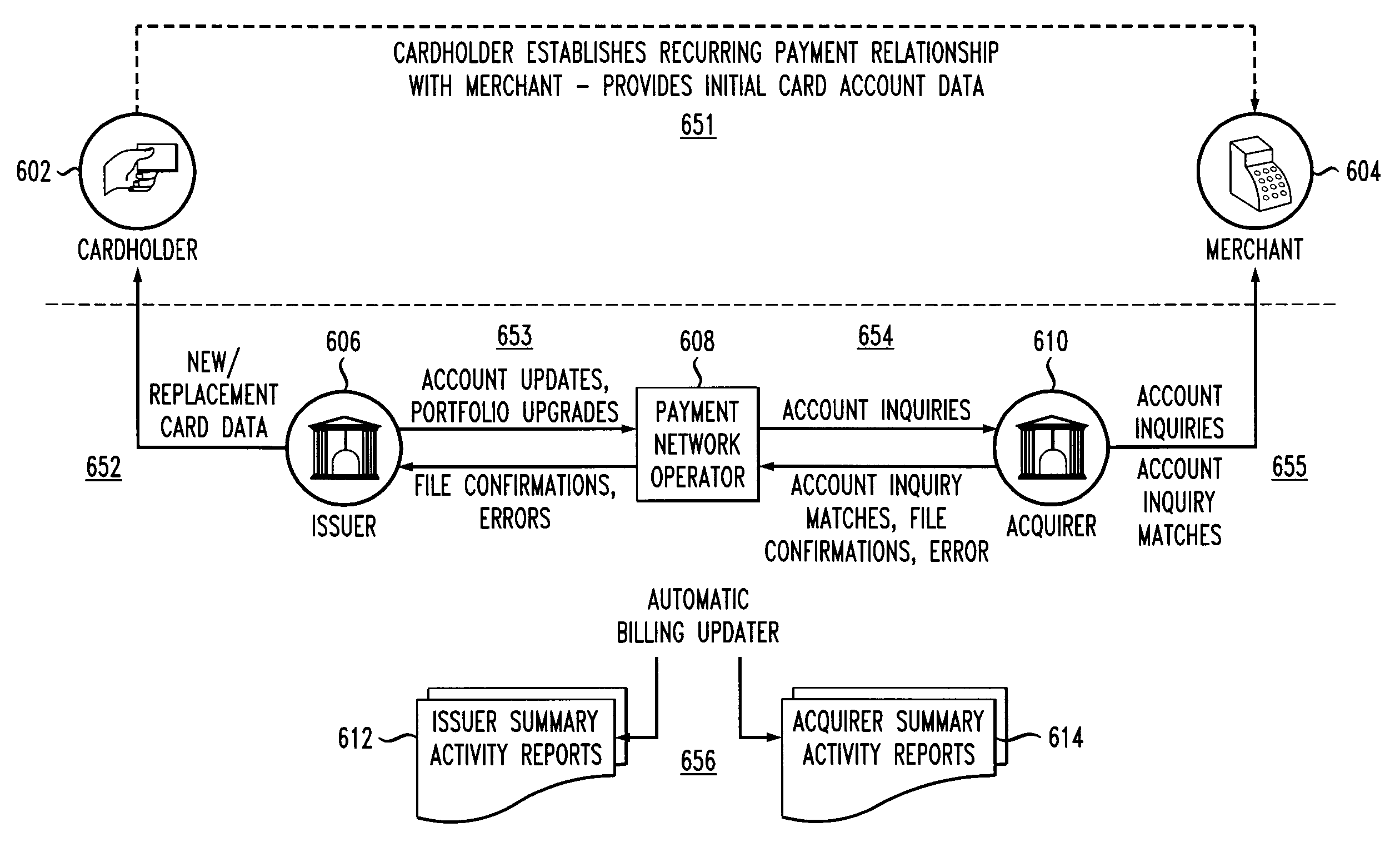

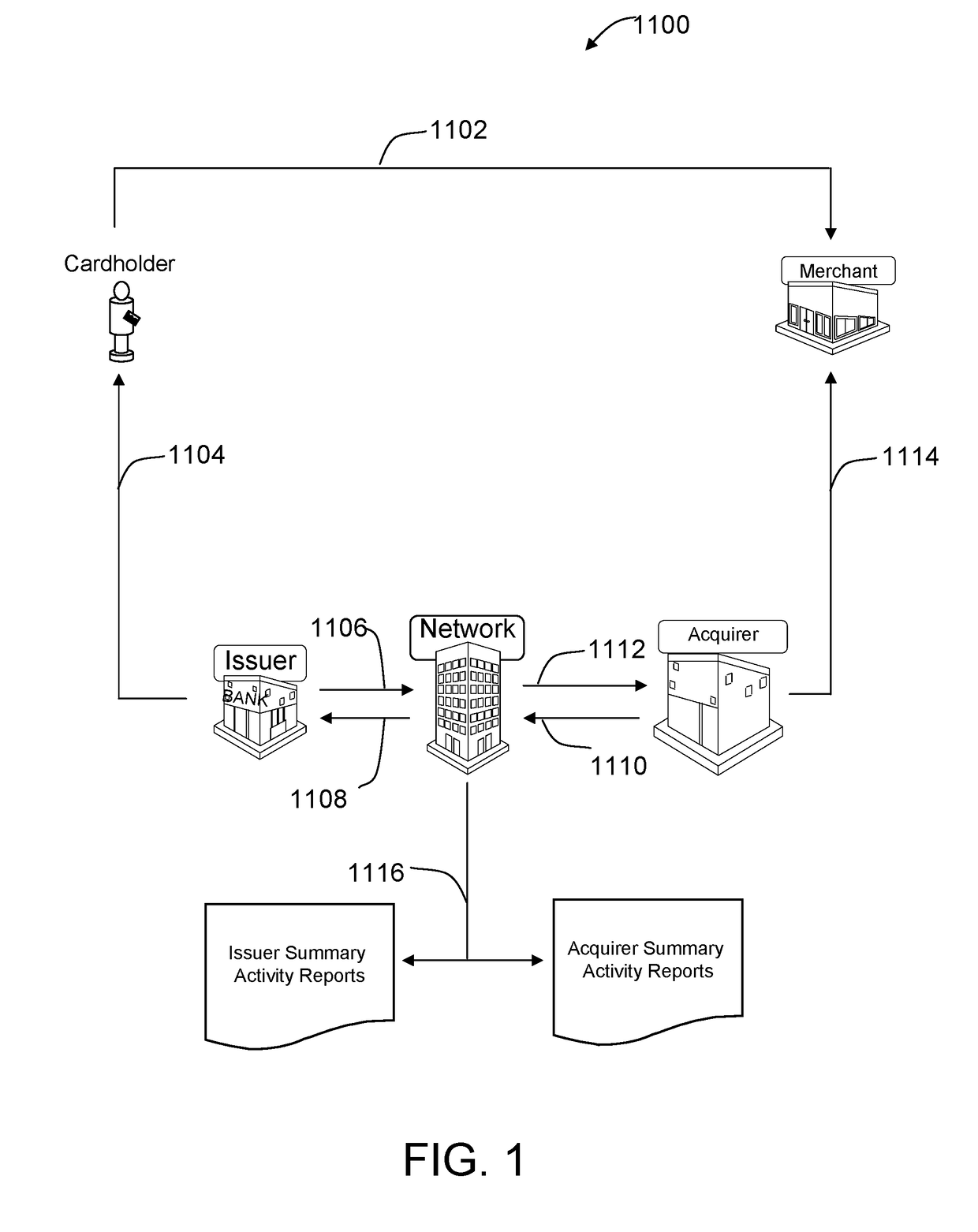

Systems and methods for updating payment card expiration information

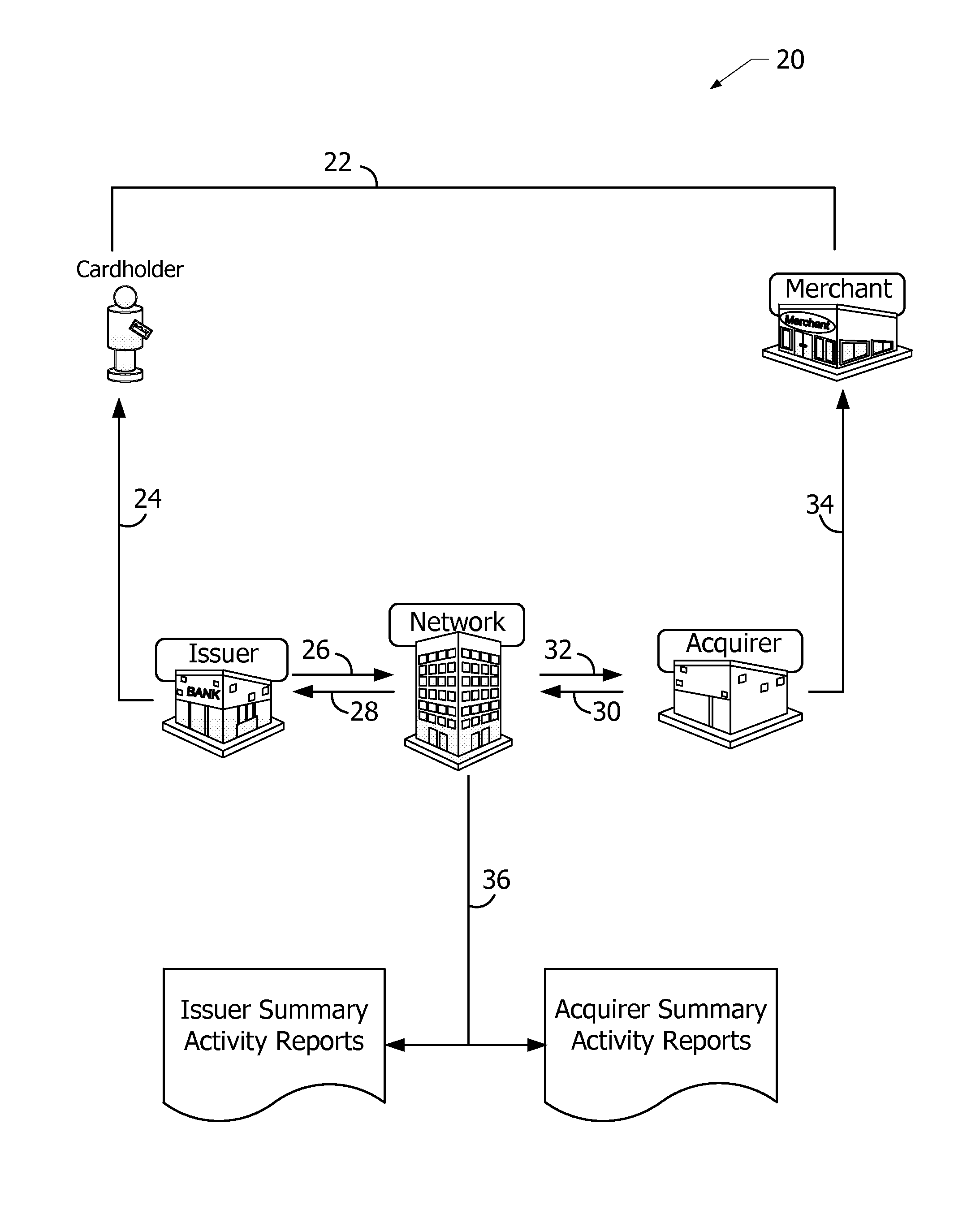

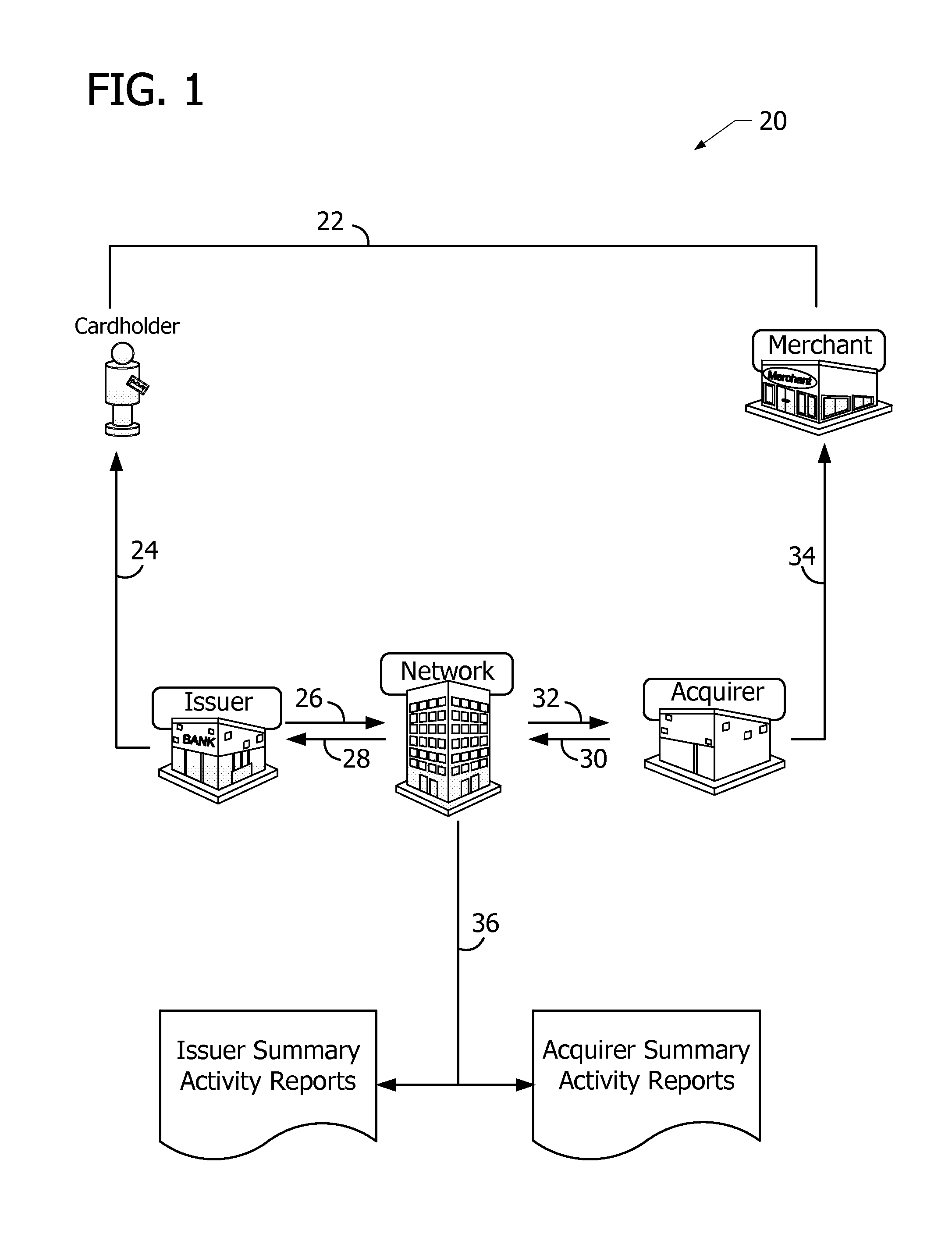

A computer-implemented method for updating merchant information regarding card-not-present recurring payment (CNP / RP) transactions is provided, wherein the method involves a recurring transaction initiated by a cardholder using payment card information stored by a merchant. The method includes querying a database coupled to a payment network to identify a candidate payment card having stale payment card data. The stale payment card data includes at least an existing expiration date that is within a predetermined period of time of a selected calendar date. The method also includes querying the database to identify at least one recent transaction involving the candidate payment card. The recent transaction includes payment card data having an updated expiration date. The method further includes notifying the merchant that the existing expiration date has been replaced with the updated expiration date.

Owner:MASTERCARD INT INC

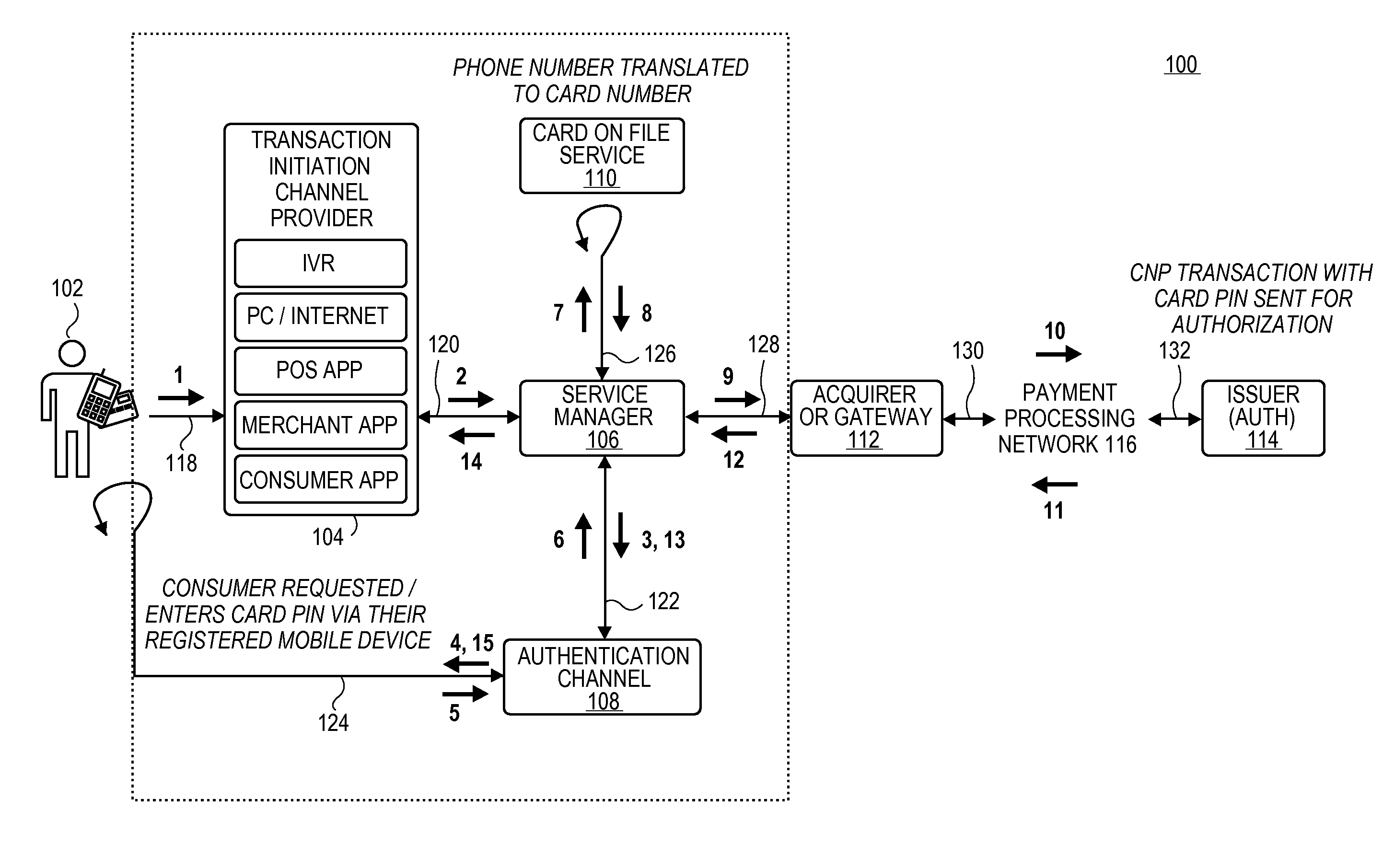

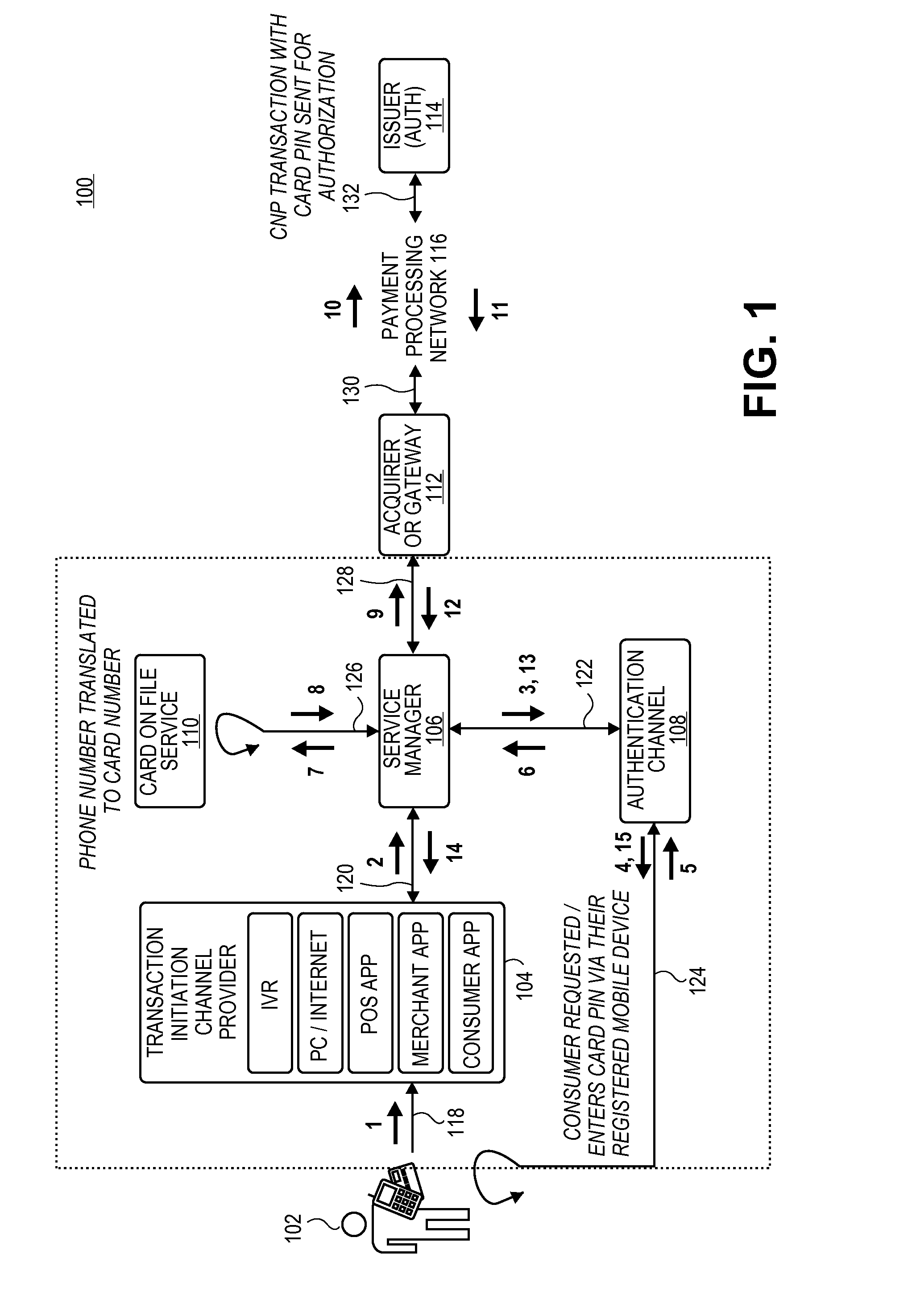

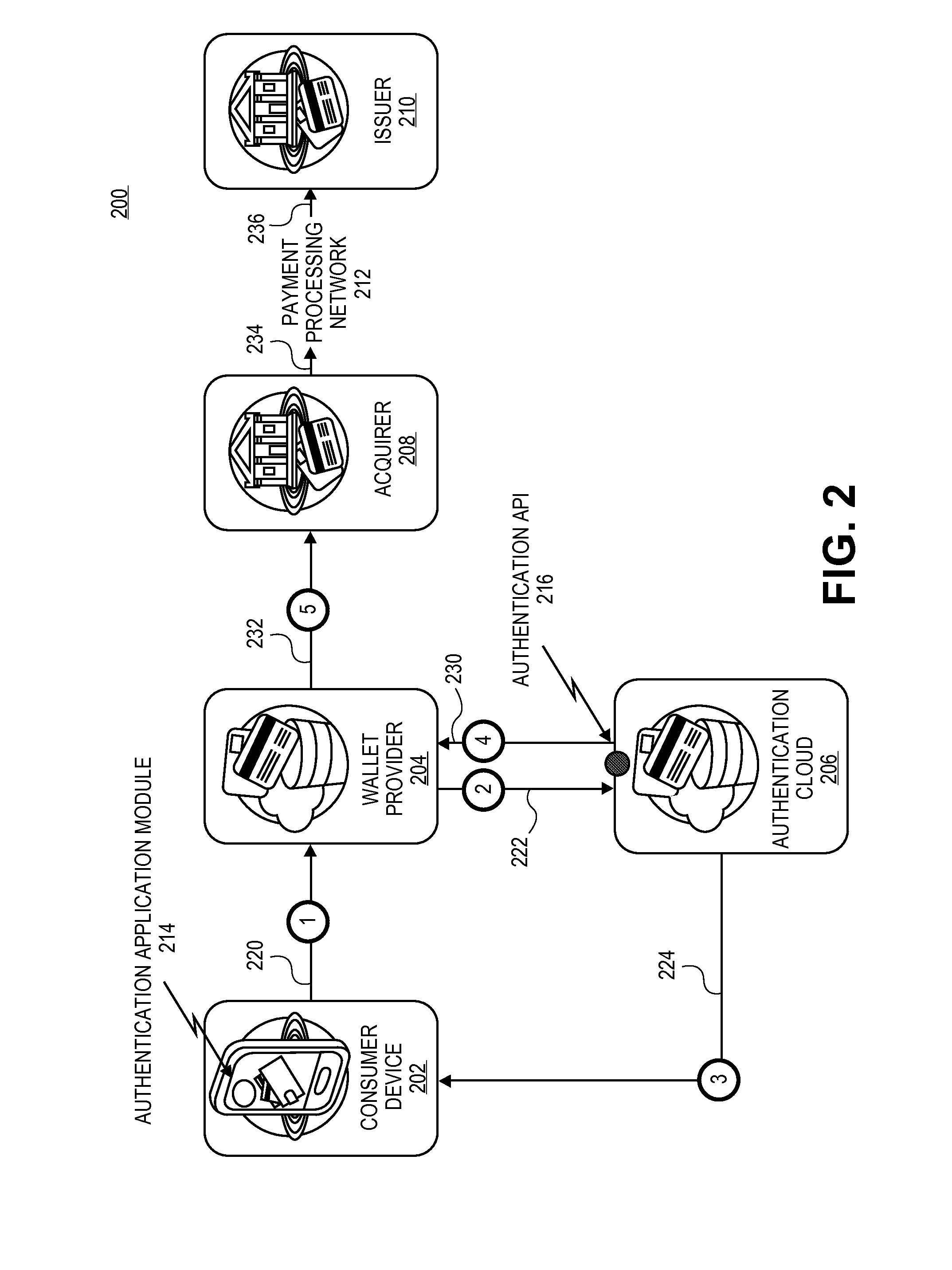

Authenticating Remote Transactions Using a Mobile Device

Embodiments of the invention can combine card not present transaction processing with PIN verification. A merchant or a consumer can initiate transactions using any suitable transaction initiation channel. One aspect of the invention helps facilitate payment card authentication across multiple wallet providers / merchants using an encrypted card PIN and a digital certificate. One aspect of the invention can incorporate the use of different transaction networks to perform authentication and authorization processing.

Owner:VISA INT SERVICE ASSOC

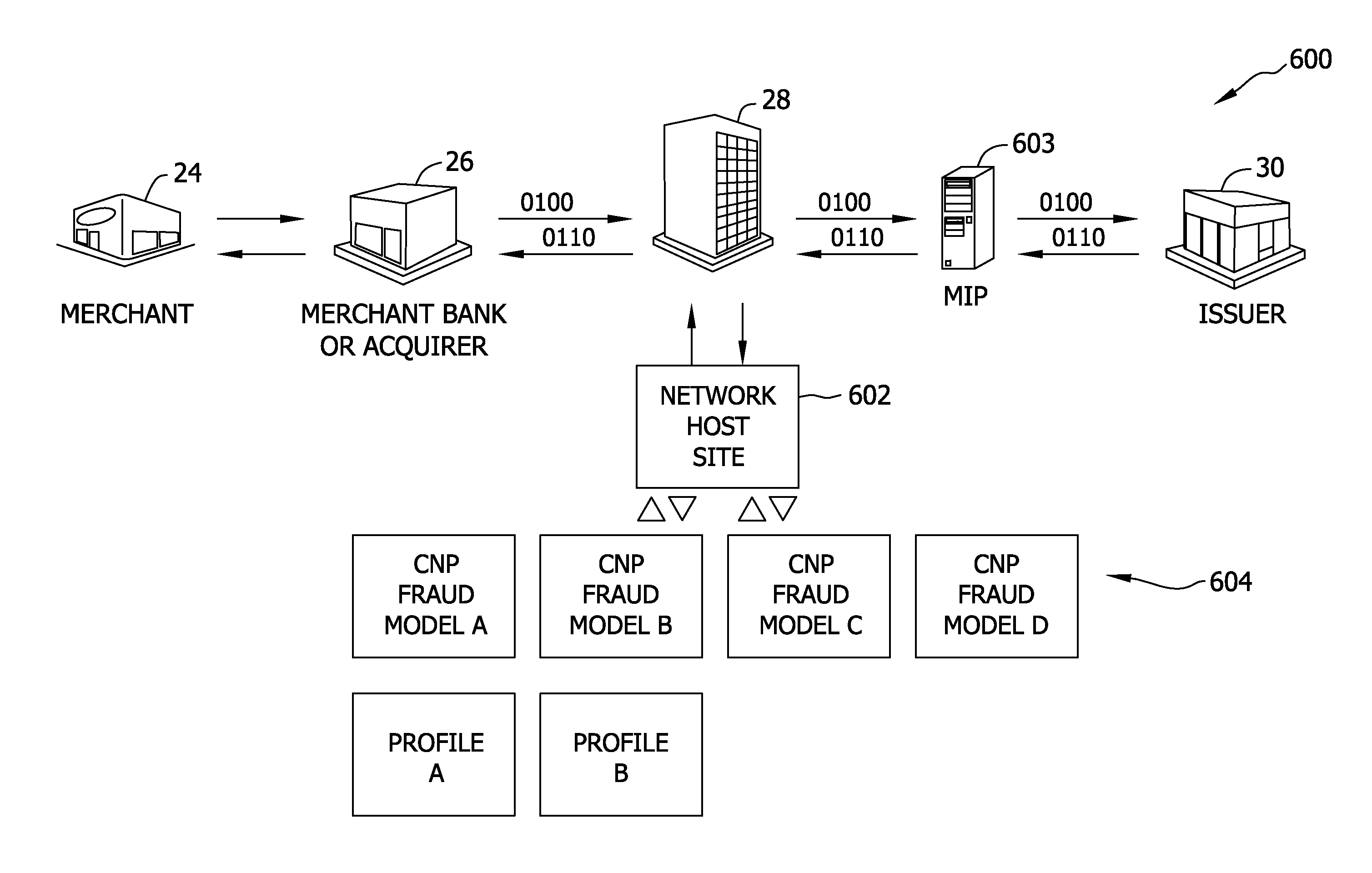

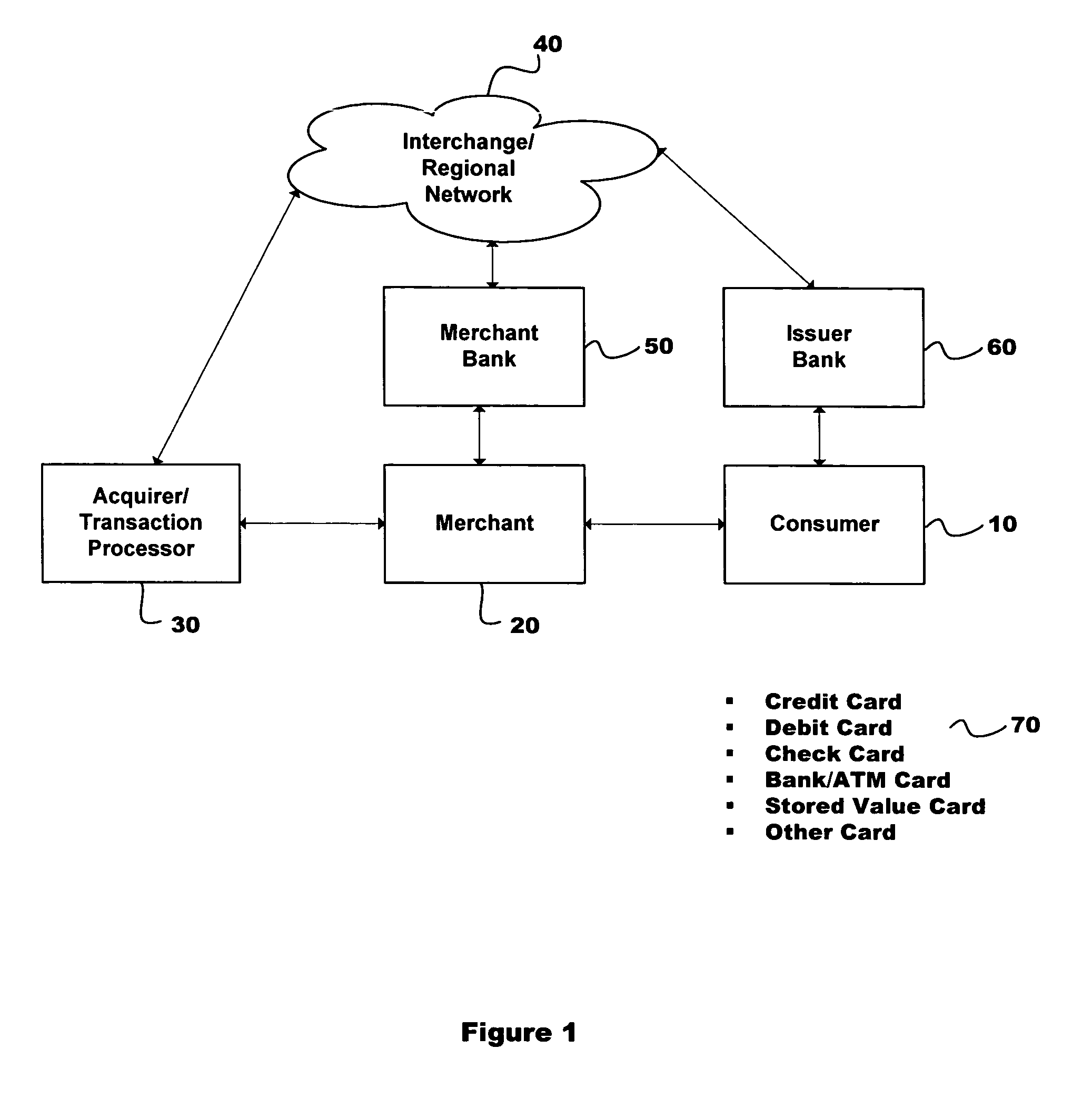

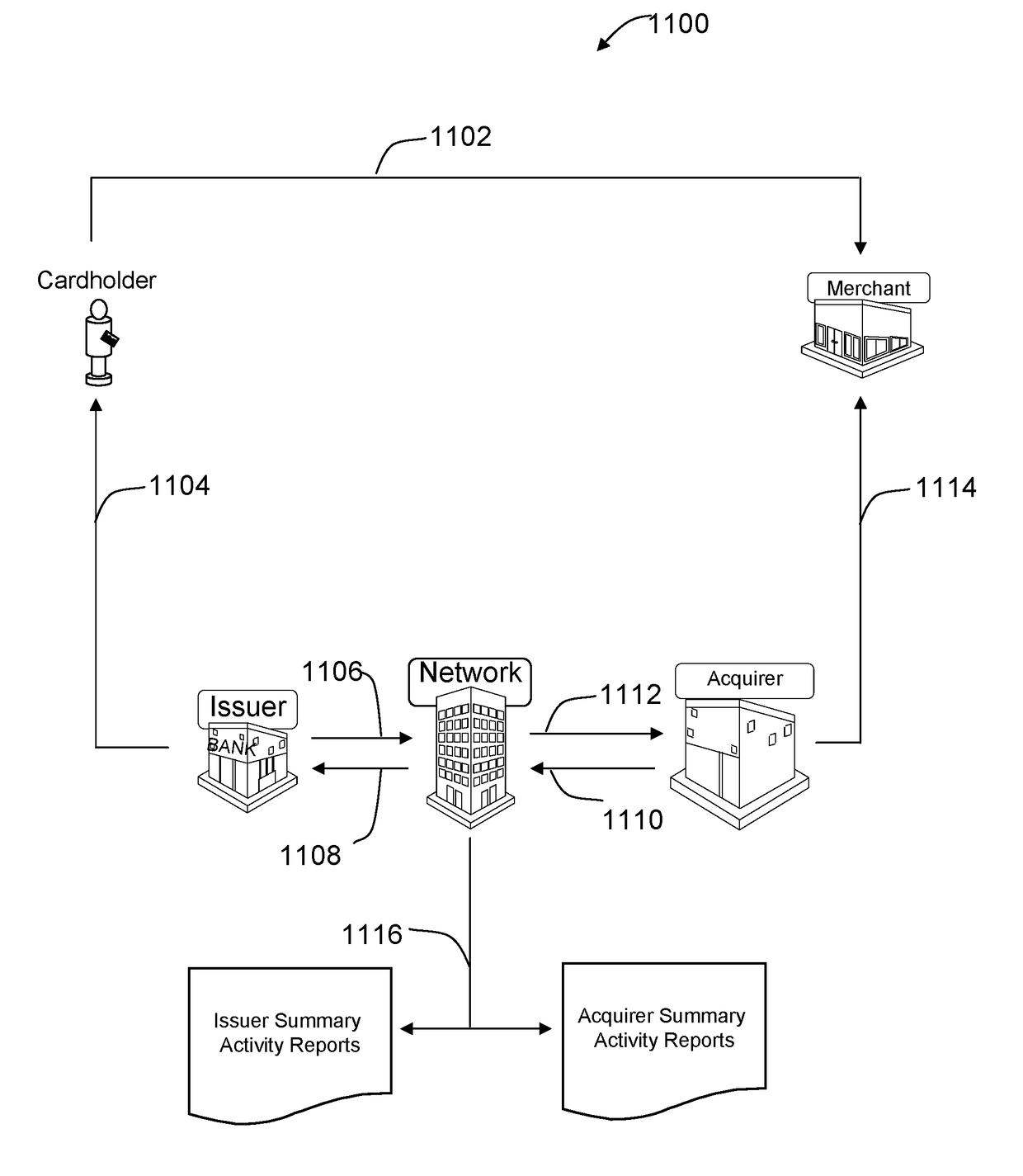

Method and system for determining fraud in a card-not-present transaction

A computer system for fraud detection associated with a card-not-present payment card system is provided. The system includes a network host site and an interchange network including a processor communicatively coupled to a memory device for storing data and to the network host site wherein the processor is programmed to receive a card transaction authorization request message from a merchant, route the card transaction authorization request to the network host site to perform CNP fraud risk scoring, and based on the criteria of the card transaction authorization request, call at least one of a plurality of fraud scoring models defined for criteria of the transaction authorization request. The processor is further programmed to calculate the fraud risk score based on the current transaction authorization request data and an updated card account profile, and transmit the message to an issuer of the payment card for approval of the request.

Owner:MASTERCARD INT INC

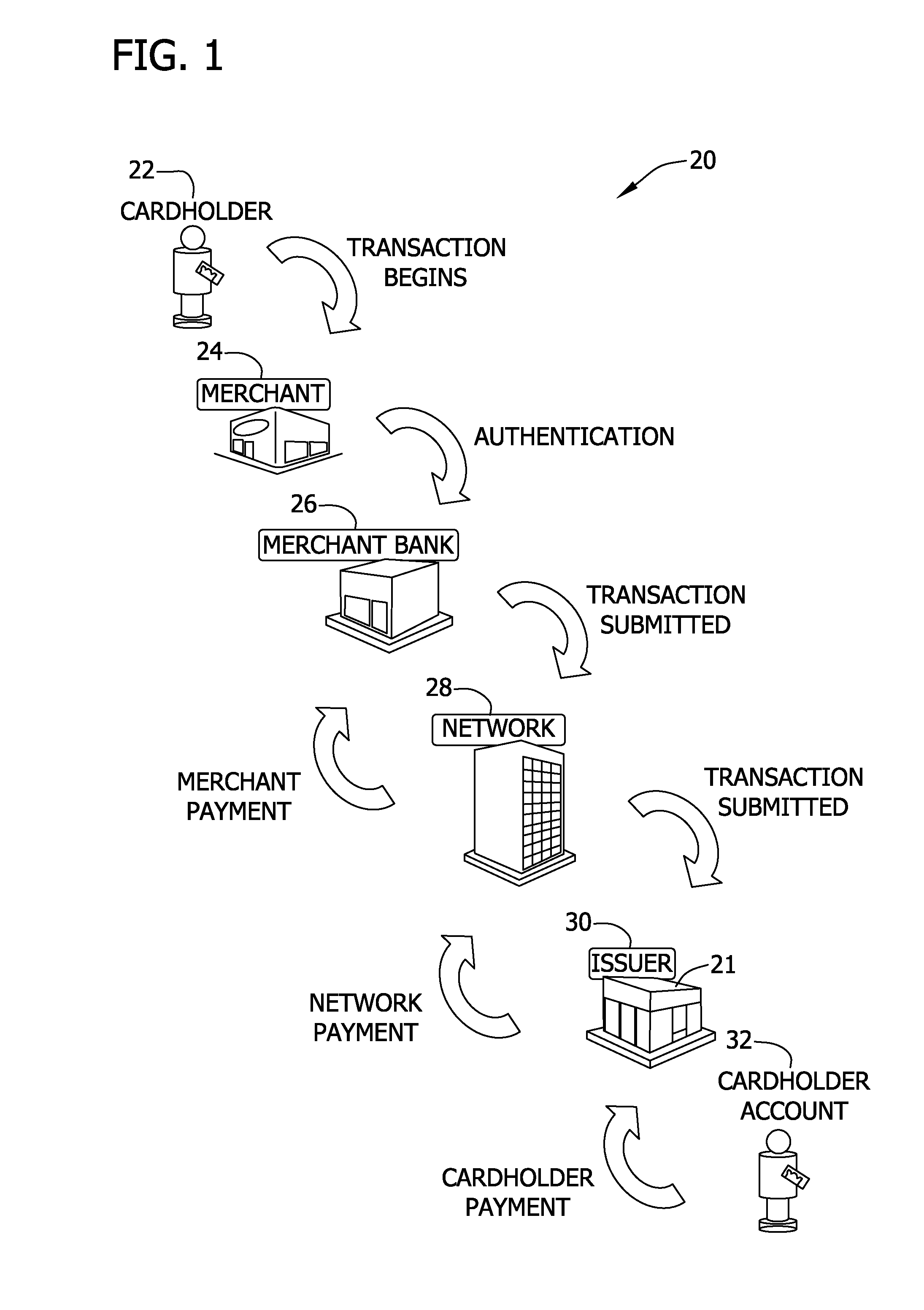

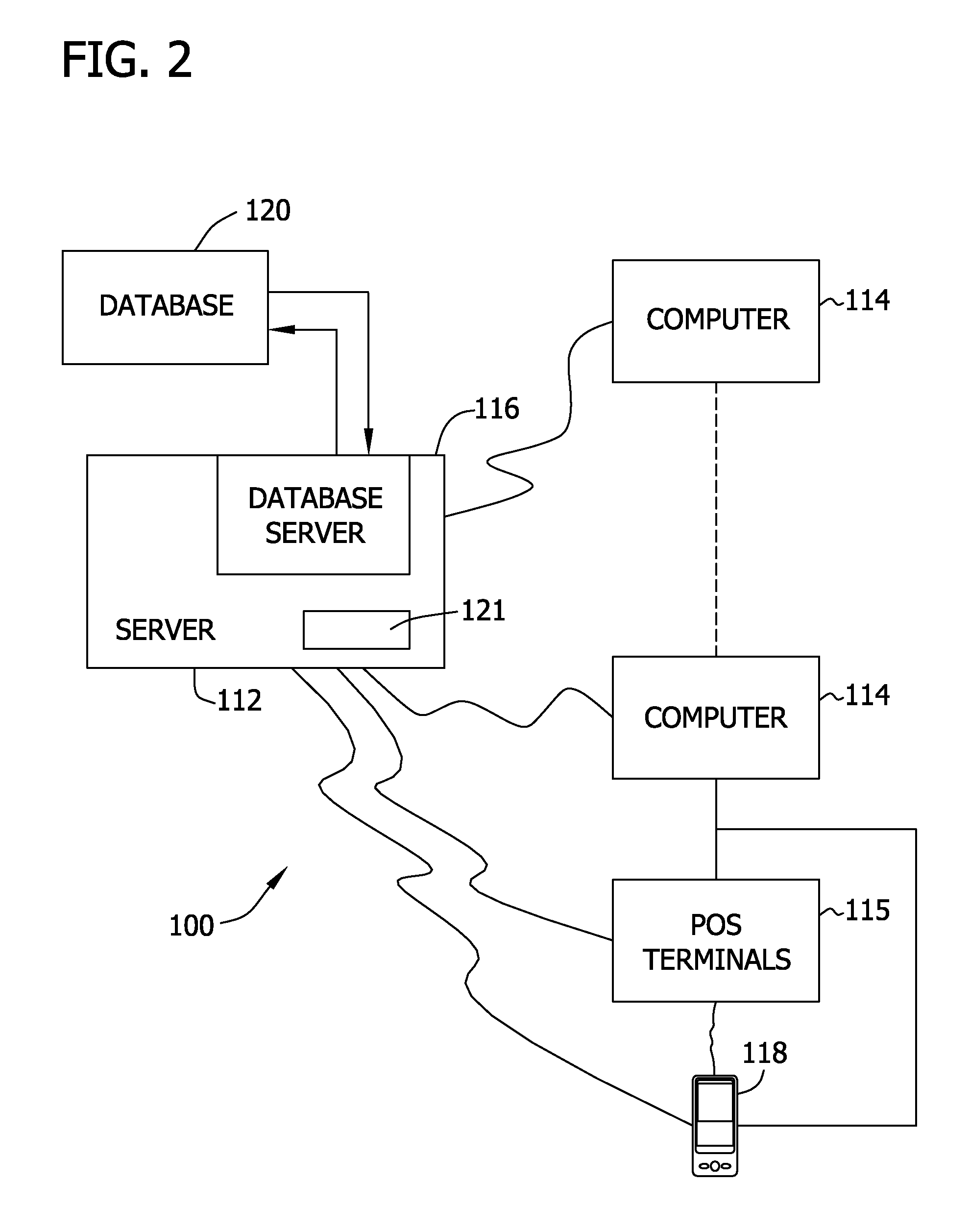

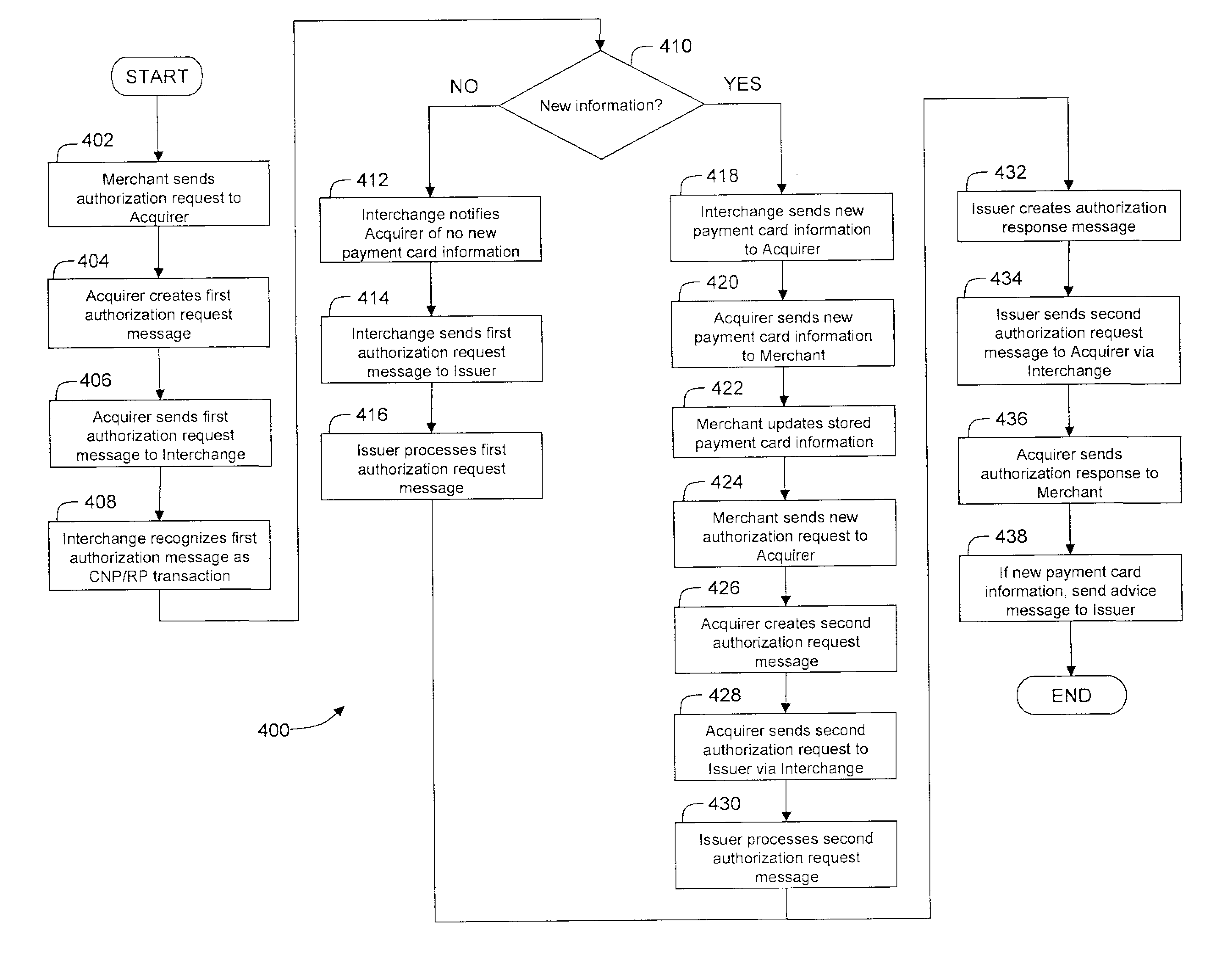

Systems and methods for processing recurring payment transactions

Systems and methods for updating payment card records in real time for payment cards registered to be used for recurring payments in which the payment card itself is not present. In one aspect, a method for processing card-not-present recurring payment (CNP / RP) transactions is provided. The transactions include recurring purchases made by a cardholder using payment card information stored by a merchant. The method includes receiving, at an interchange network, a first authorization request message for the transaction, and querying a database coupled to the interchange network to determine whether the database includes updated payment card information for a payment card used in the transaction. The method also includes transmitting the updated payment card information from the interchange network to the merchant and updating the payment card information stored by the merchant to match the updated payment card information received from the interchange network.

Owner:MASTERCARD INT INC

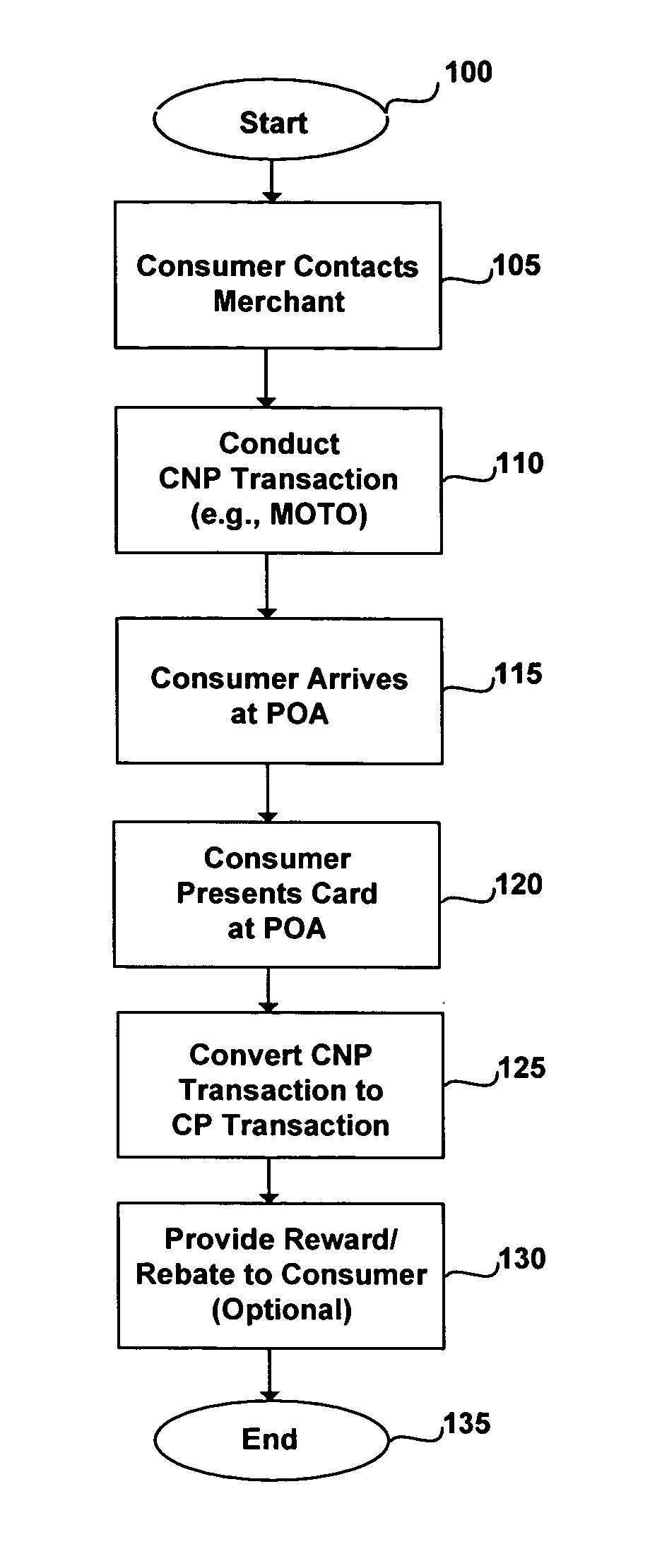

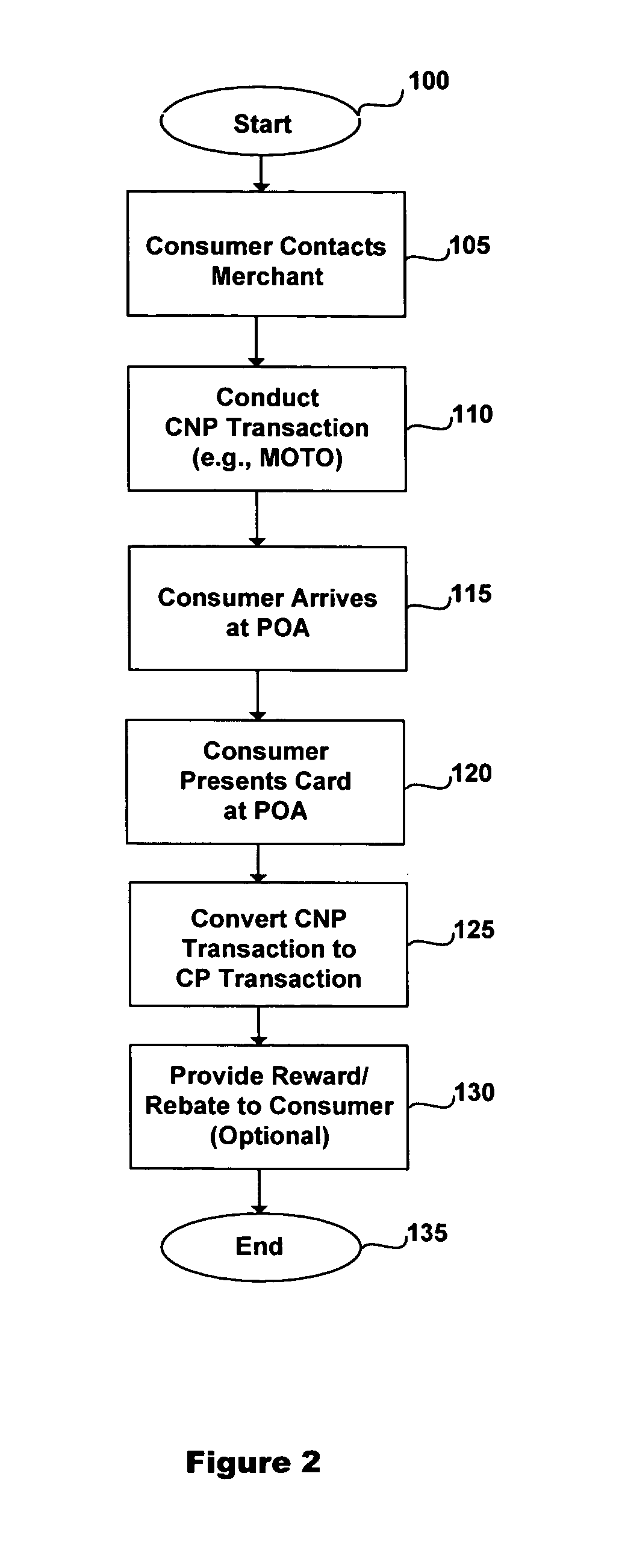

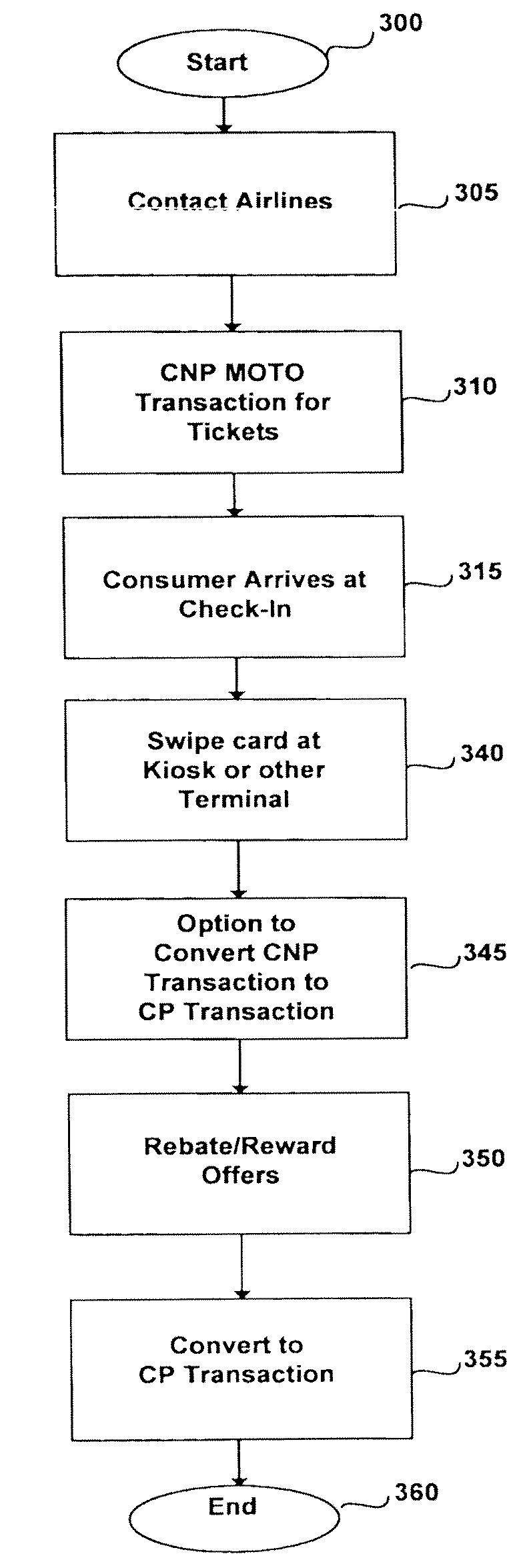

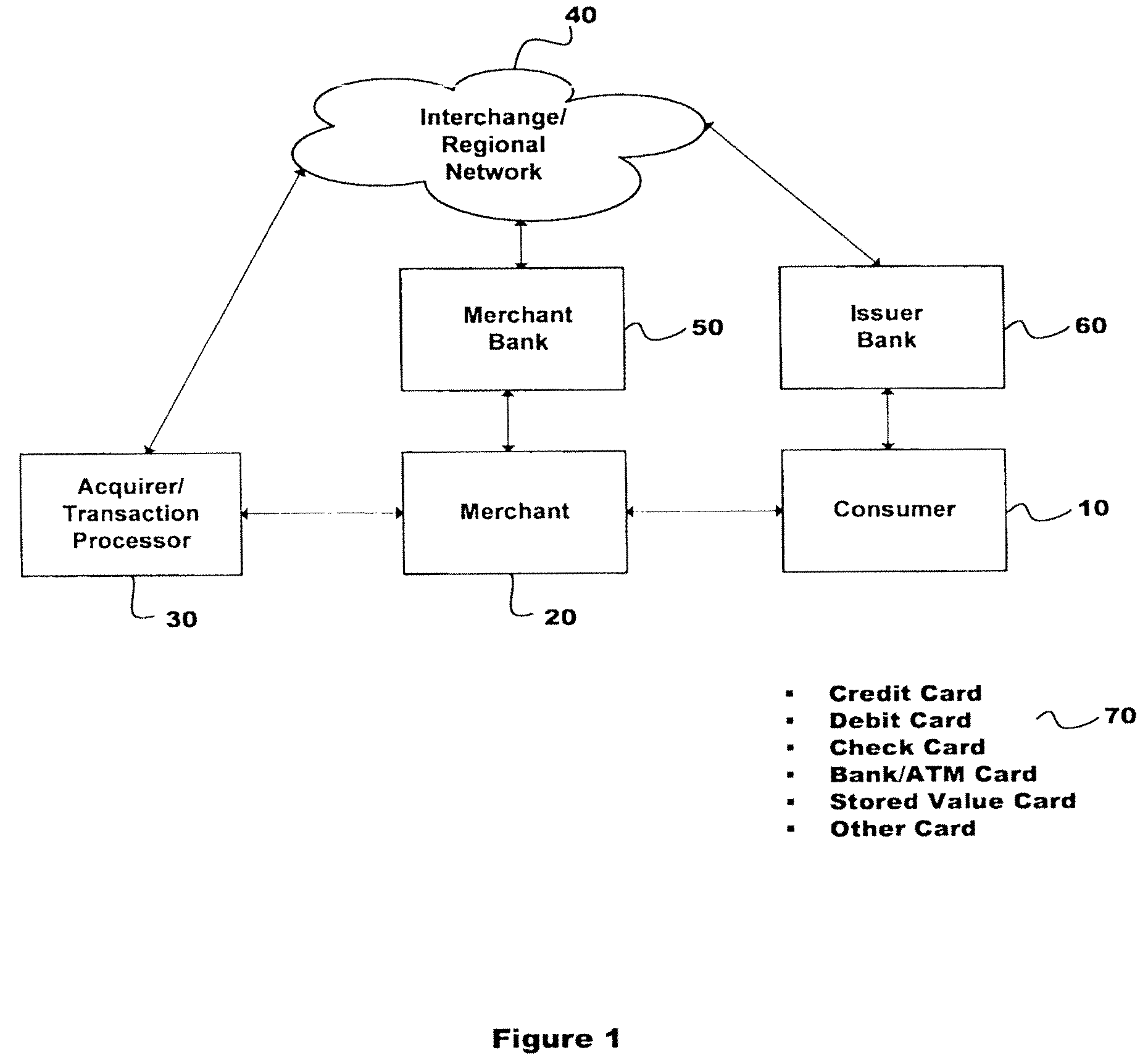

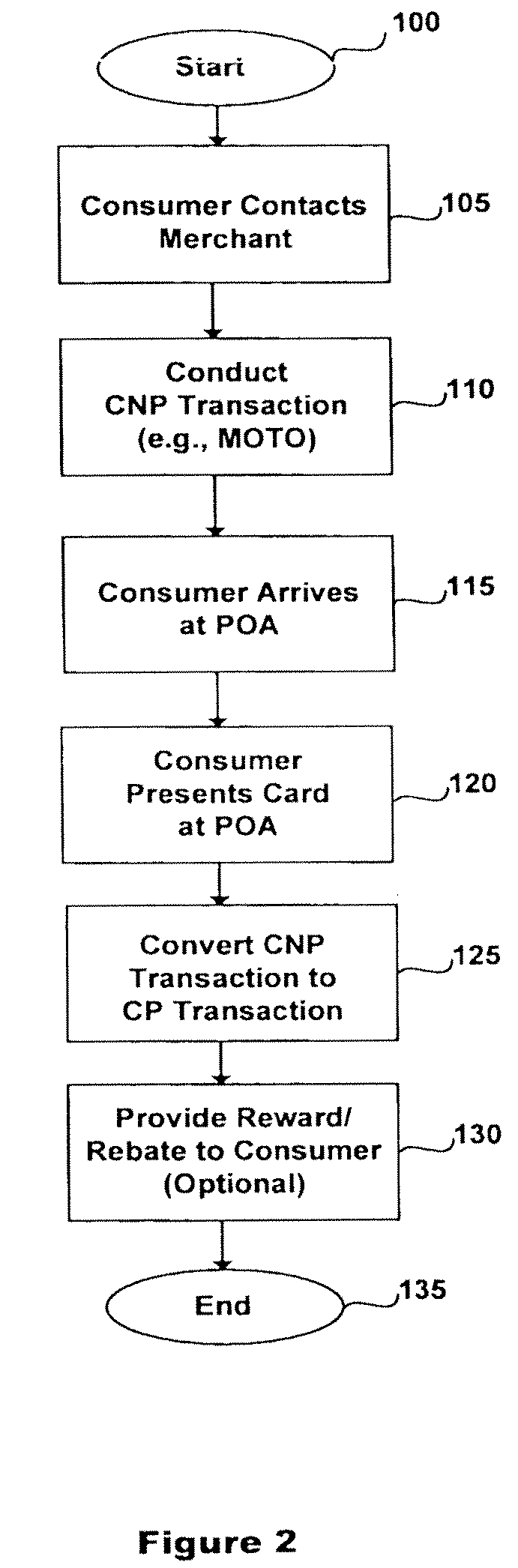

System and method for conversion of initial transaction to final transaction

ActiveUS7702577B1Transaction feeImprove efficiencyFinancePayment protocolsFinancial transactionCard reader

The invention comprises a system and method for converting initial financial transactions into final financial transactions entailing lower transaction fees or which are otherwise more advantageous. According to one embodiment of the invention, a card not present (CNP) transaction is conducted for a remote consumer buying goods / services. When the consumer later arrives at a point of authentication (POA), the consumer is presented with an opportunity to have the CNP transaction effectively converted to a card present (CP) transaction using the same card instrument or a different card instrument. The merchant benefits because the transaction fees are much reduced for the CP transaction compared to the CNP transaction. The consumer may benefit from rewards / rebates or other inducements to authorizing the subsequent transaction. One preferred embodiment implements the invention in the airlines environment, wherein tickets ordered over the phone or on-line using a first CNP transaction are converted to a CP transaction when the consumer swipes his / her card at an airport kiosk card reader device.

Owner:U S BANCORP LICENSING +1

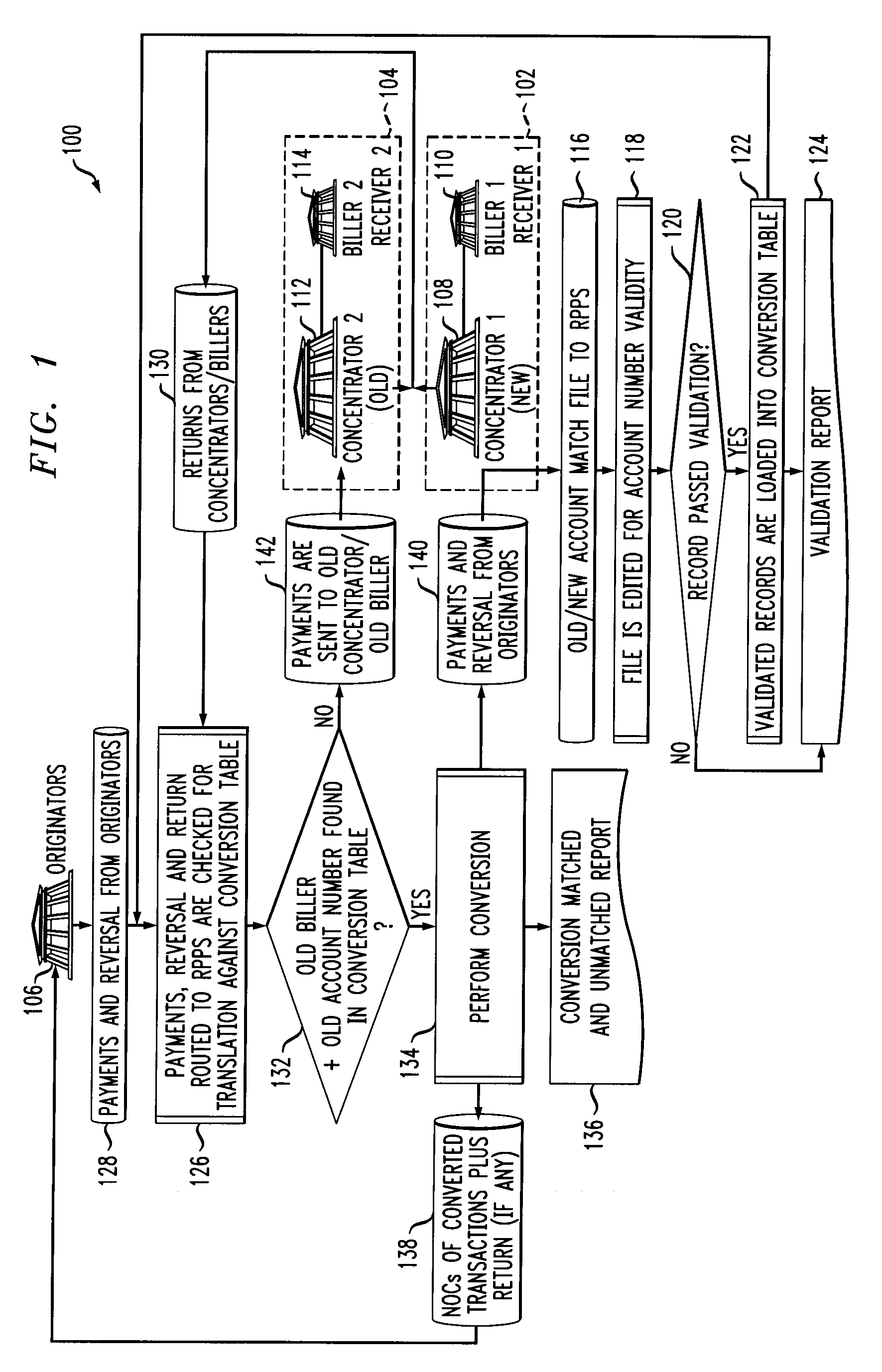

Integrated File Structure Useful in Connection with Apparatus and Method for Facilitating Account Restructuring in an Electronic Bill Payment System

ActiveUS20100174644A1Facilitating account restructuringEasy to useComplete banking machinesFinancePayment transactionPayment order

An electronic funds transfer bill payment operation of a financial institution receives first information representing an account restructuring of a biller which uses the electronic funds transfer bill payment operation. The first information is combined with second information into a uniformly formatted file. The second information is formatted differently than the first information. The second information includes card update information for recurring payment card payments made with payment cards issued by the financial institution. The uniformly formatted file is transferred to an operator of a payment network of a kind configured to facilitate transactions between multiple issuers and multiple acquirers. The uniformly formatted file specifies at least one old account number associated with a biller and at least one new account number associated with the biller. The payment network operator operates both a recurring payment transaction system for card-not-present recurring payments and an electronic funds transfer account conversion application in accordance with the uniformly formatted file.

Owner:MASTERCARD INT INC

System and method for conversion of initial transaction to final transaction

ActiveUS7702553B1Reduce riskImprove efficiencyFinancePayment protocolsFinancial transactionCard reader

The invention comprises a system and method for converting initial financial transactions into final financial transactions entailing lower transaction fees or which are otherwise more advantageous. According to one embodiment of the invention, a card not present (CNP) transaction is conducted for a remote consumer buying goods / services. When the consumer later arrives at a point of authentication (POA), the consumer is presented with an opportunity to have the CNP transaction effectively converted to a card present (CP) transaction using the same card instrument or a different card instrument. The merchant benefits because the transaction fees are much reduced for the CP transaction compared to the CNP transaction. The consumer may benefit from rewards / rebates or other inducements to authorizing the subsequent transaction. One preferred embodiment implements the invention in the airlines environment, wherein tickets ordered over the phone or on-line using a first CNP transaction are converted to a CP transaction when the consumer swipes his / her card at an airport kiosk card reader device.

Owner:JPMORGAN CHASE BANK NA +1

Dynamic Card Verification Values and Credit Transactions

A system and method for providing card verification values for card-not-present transactions is described. In one example, a user's computing device stores single-use CVVs to be provided from a secure wallet. The secure wallet may be software running on the user's computing device. Alternatively, it may be an external device connectable to the user's computing device, which accesses the external device to obtain the single-use CVV.

Owner:AURA SUB LLC +1

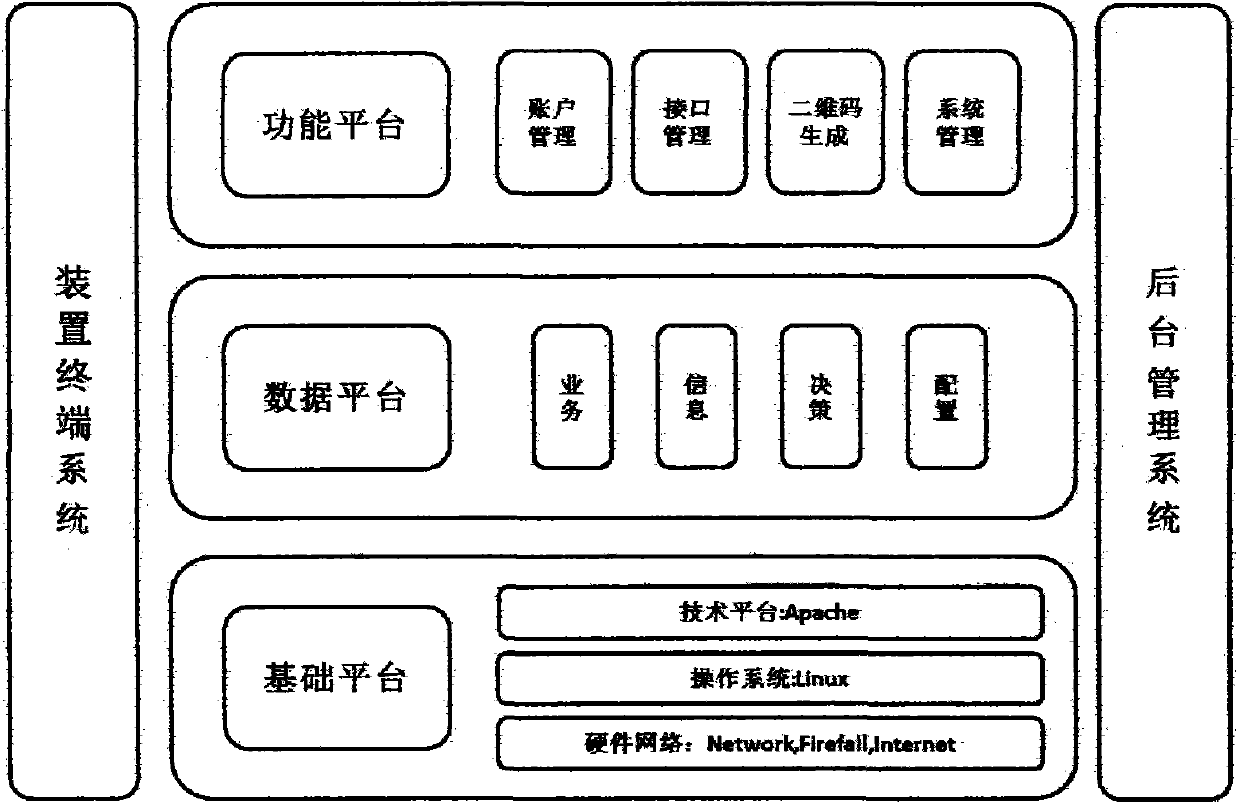

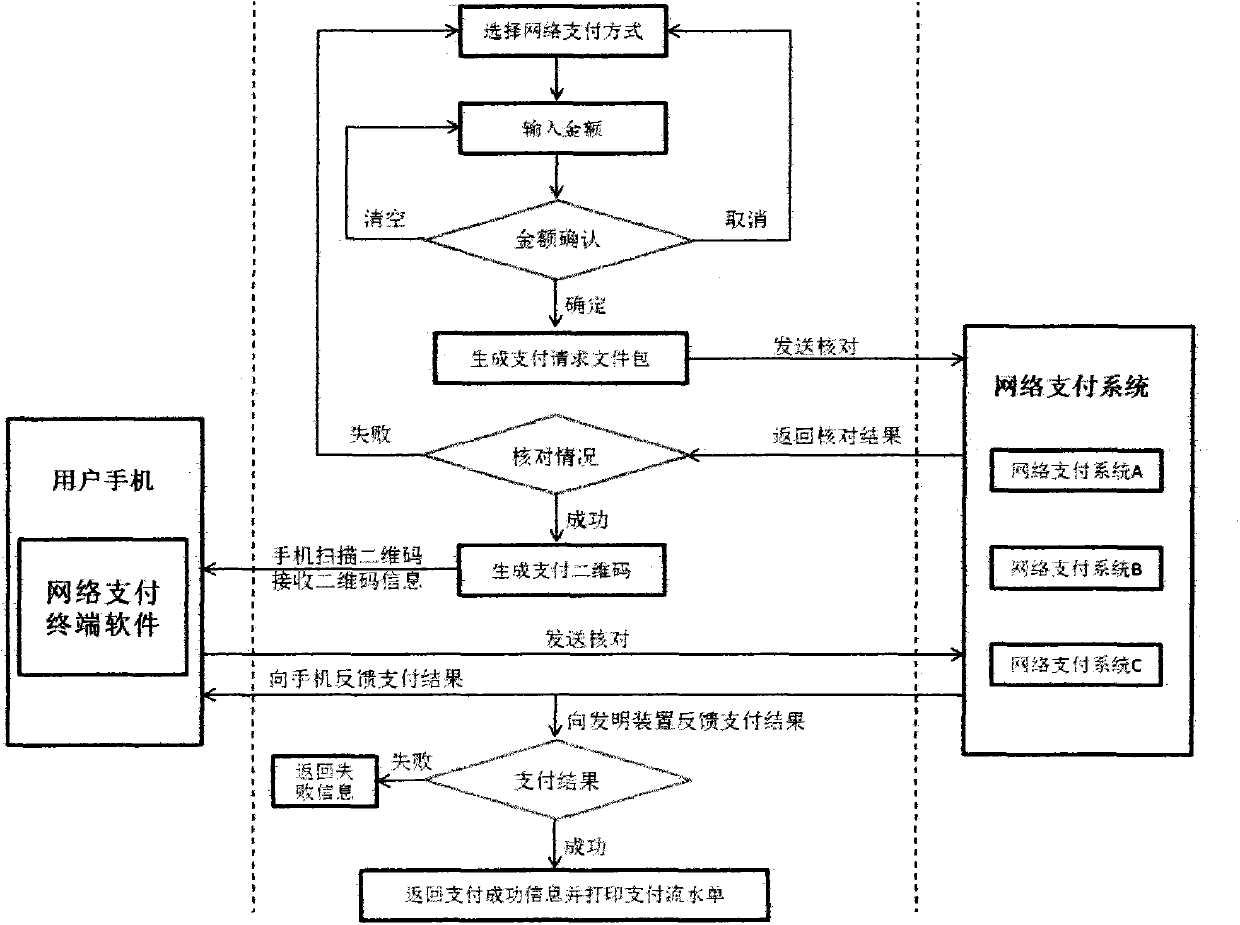

Online payment method and system thereof

ActiveCN103679445ARealization of card-not-present paymentGood application basisPayment architectureUser inputPassword

The invention discloses an online payment method. The online payment method is characterized by comprising steps of: (1) being associated with a plurality of online payments accounts of businesses; (2) allowing the businesses to select a method of payment and enter an amount according to an online payment system selected by users; (3) generating a two-dimension code; (4) allowing the users to scan the two-dimension code and pay by an online payment software on a mobile phone and enabling the online payment system to feed back results of completed payments to a terminal system when the users enter a password and complete the payments; (5) printing out the running information of the results of the completed payments, wherein a payment request comprises a payment amount, a product name and a payment account. The invention further discloses an online payment system. The online payment method and the system thereof has the advantages of being available to card-not-present payments, safe and convenient in operation and capable of using two-dimension codes scanned by mobile phones to achieve online payments.

Owner:YUNNEX TECH

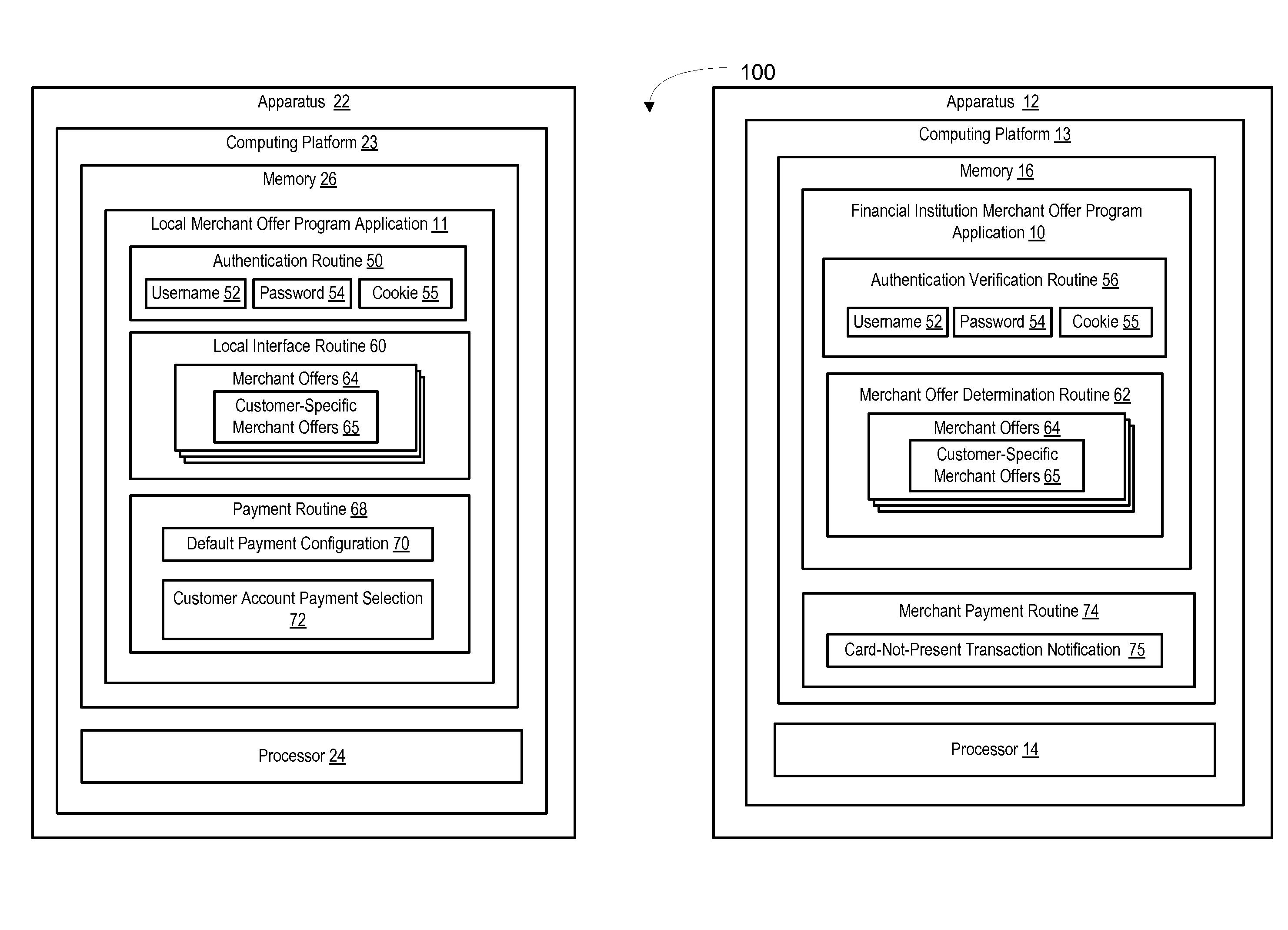

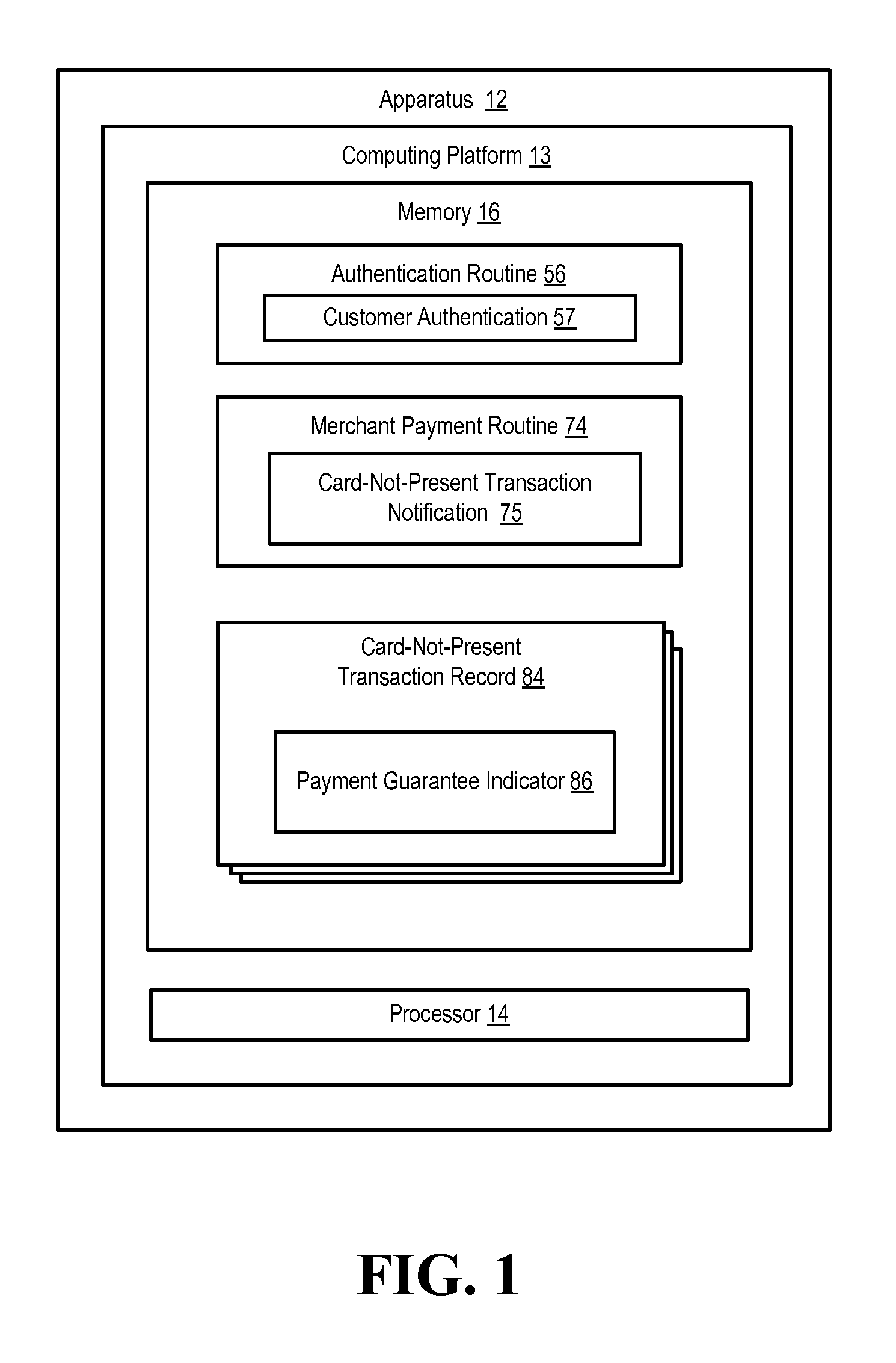

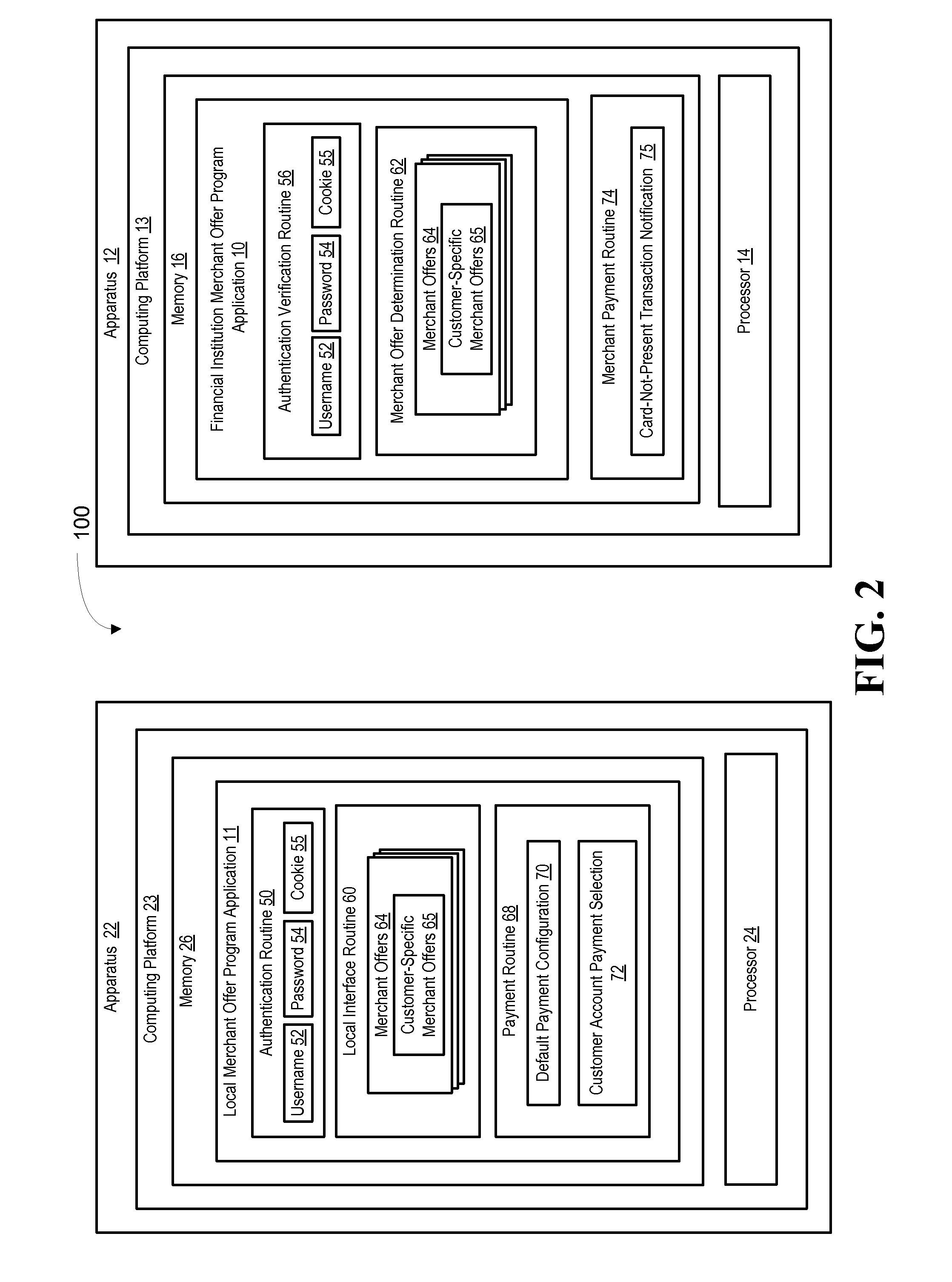

Guaranteed merchant payment in a card-not-present transaction

Embodiments of the invention provide for systems, devices, apparatus, methods and computer program products for payment card-issuing entities to guarantee merchant payment in card-not-present-transactions and, more specifically, automatically guaranteeing merchant payment in card-not-present transactions based on the payment card-issuing entity authenticating the customer prior to the transactions. By guaranteeing merchant payment in card-not-present transactions, the merchant's risk associated with such transaction is greatly reduced.

Owner:BANK OF AMERICA CORP

Fraud reduction system for transactions

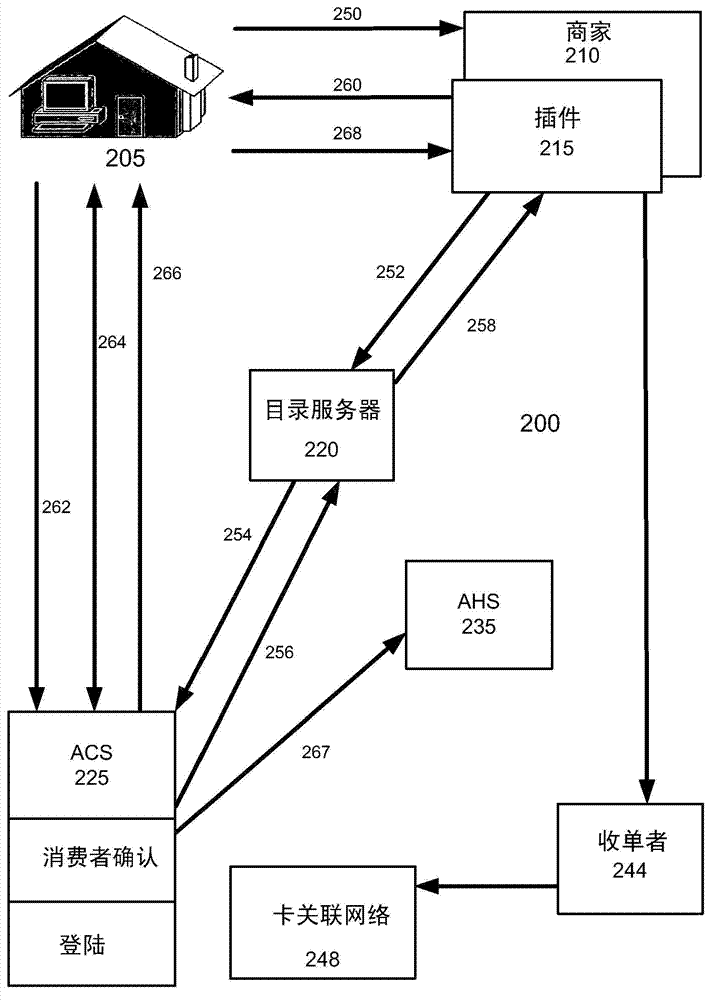

A system, apparatus, and method for reducing fraud in payment or other transactions by providing issuers with a warning that a transaction being processed for authorization is potentially fraudulent. In some embodiments, the present invention processes data obtained from a consumer authentication process that is used in card not present (CNP) transactions to determine characteristics or indicia of fraud from previous transactions. The characteristics or indicia of fraud can be used to generate a set of fraud detection rules or another form of fraud assessment model. A proposed transaction can then be evaluated for potential fraud using the fraud assessment model.

Owner:VISA INT SERVICE ASSOC

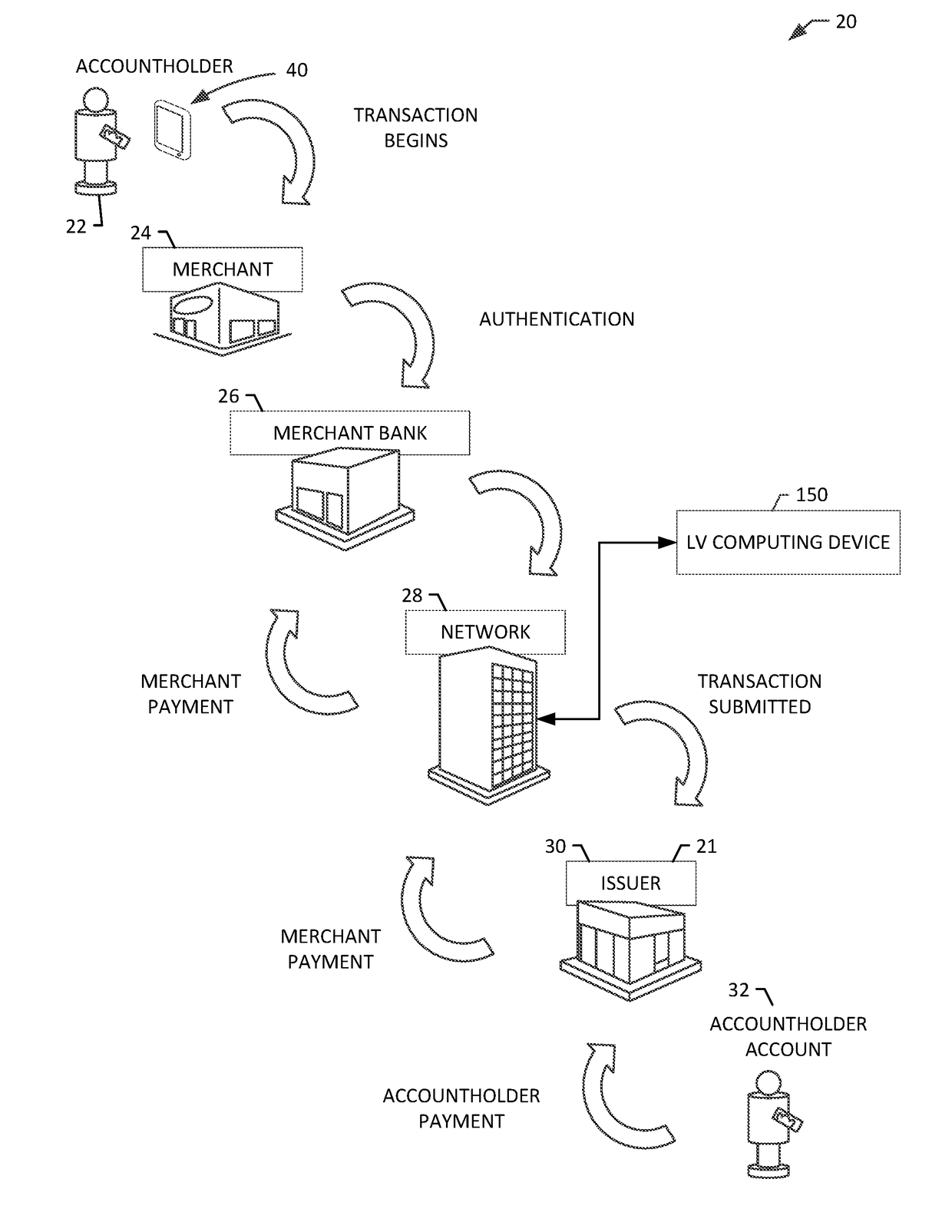

Systems and methods for location data verification

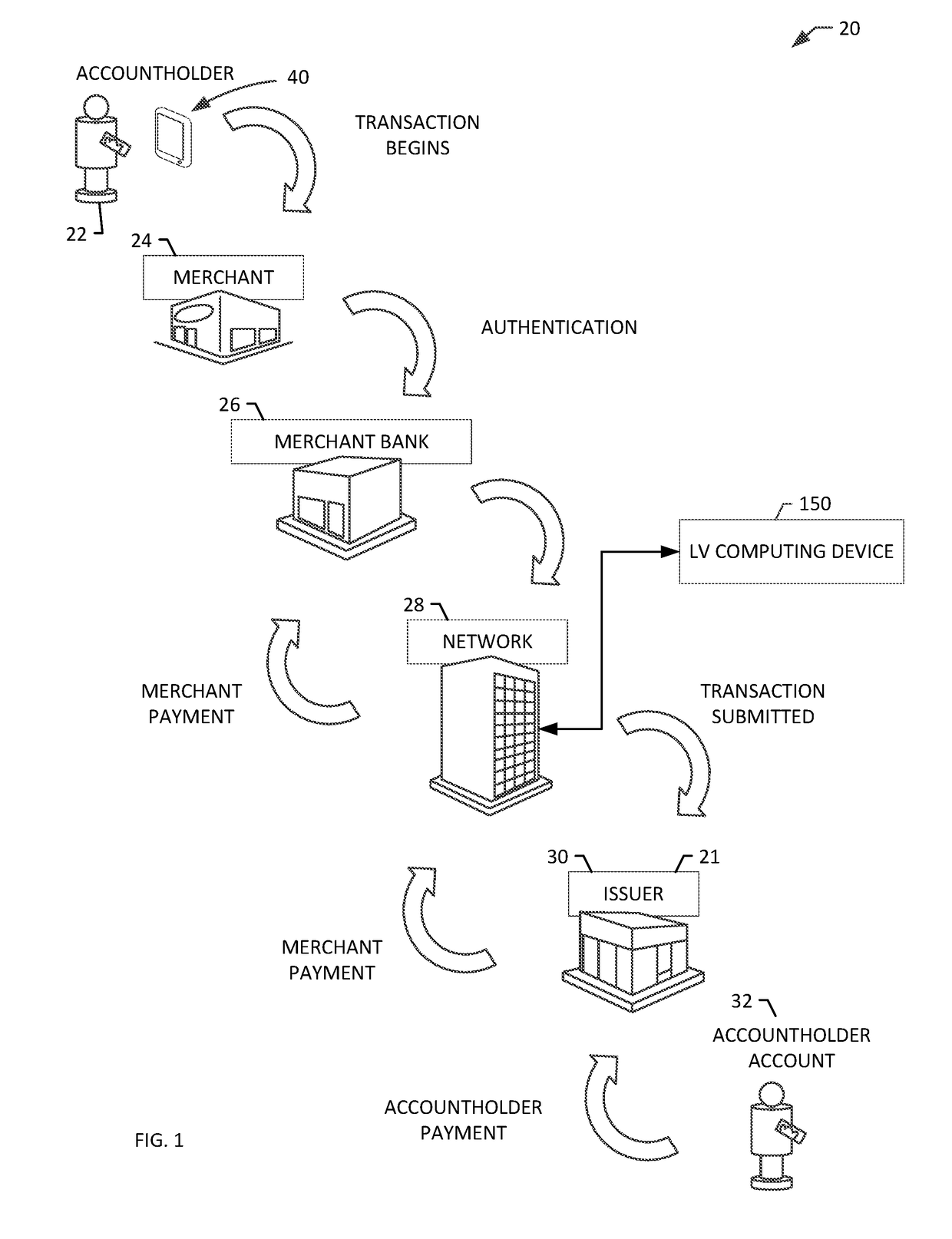

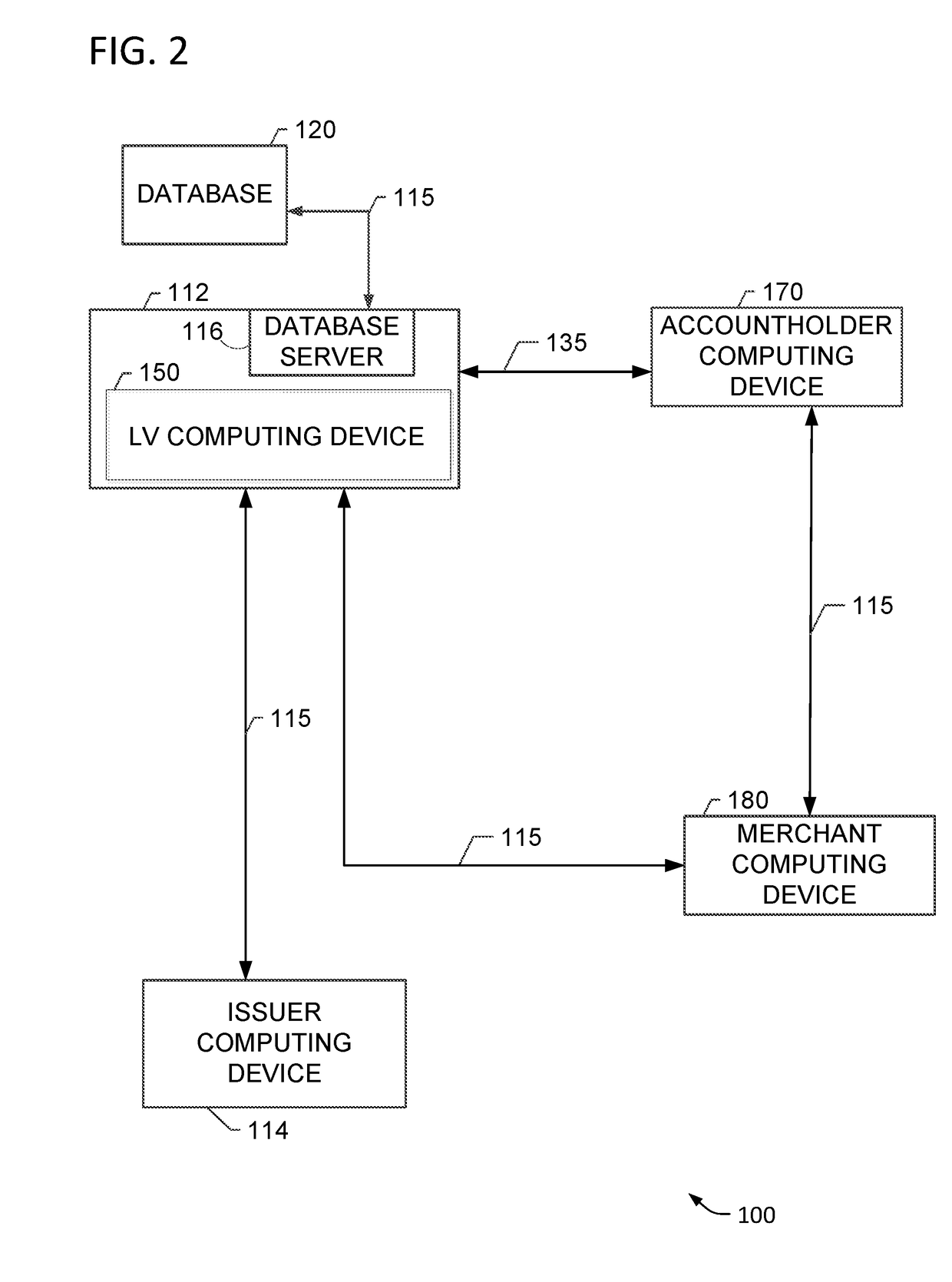

A method of verifying a location of an accountholder is provided. The method is implemented using a location verification (LV) computing device. The method includes receiving a first data message including first transaction data associated with a travel-related card-not-present transaction of the accountholder to a target location, analyzing the first transaction data to extract a first location identifier associated with the target location, receiving a second data message including second transaction data for a target location transaction performed by the accountholder at a merchant computing device associated with the target location, analyzing the second transaction data to extract a merchant location identifier corresponding to the merchant computing device for the target location transaction, verifying that the accountholder is performing the target location transaction at the target location by determining that the first location identifier matches the merchant location identifier, and authorizing the target location transaction.

Owner:MASTERCARD INT INC

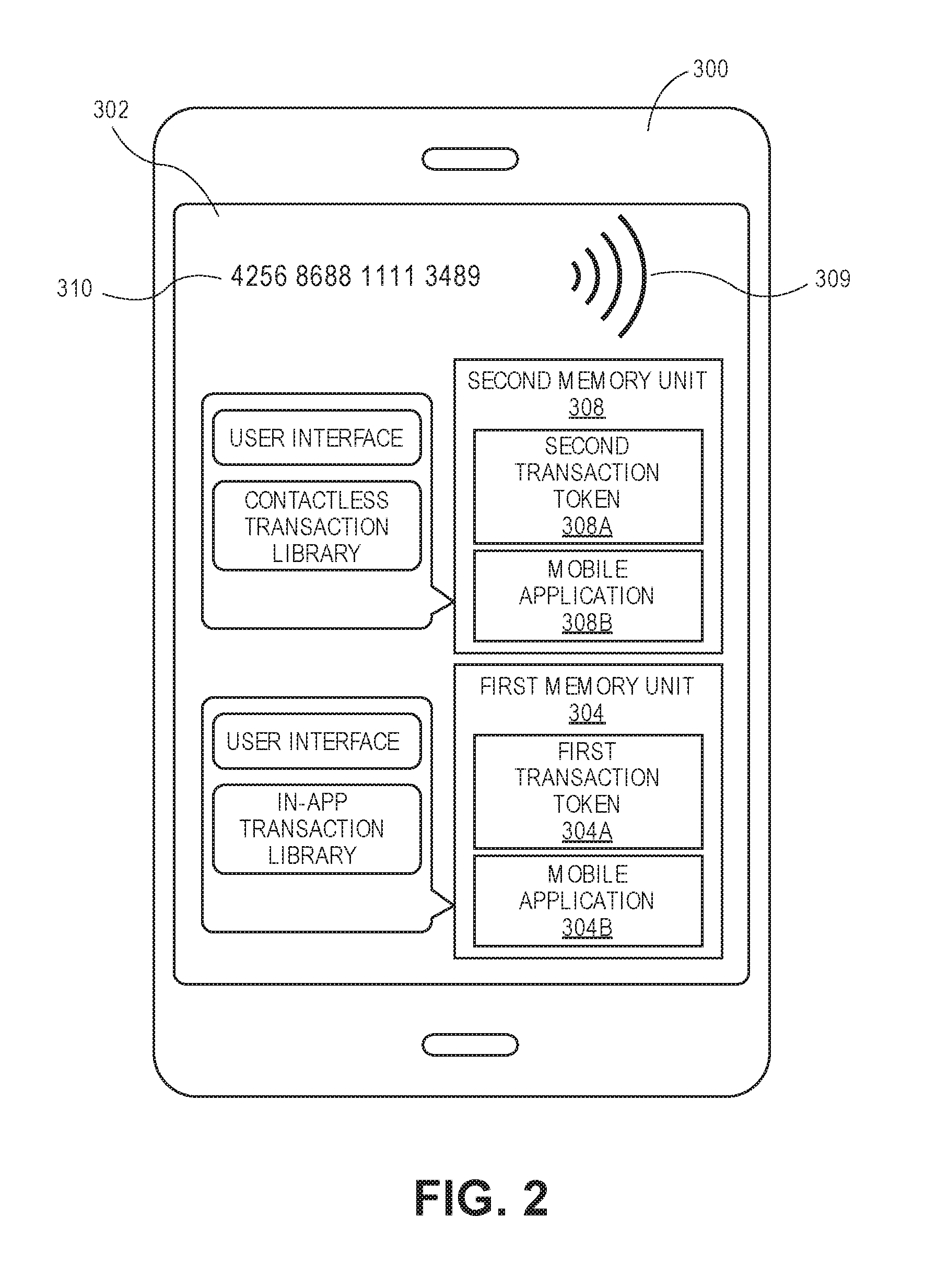

Device with multiple identifiers

InactiveUS20160267466A1Reduce probabilityFraud may be preventedAcutation objectsRecord carriers used with machinesUser deviceComputer science

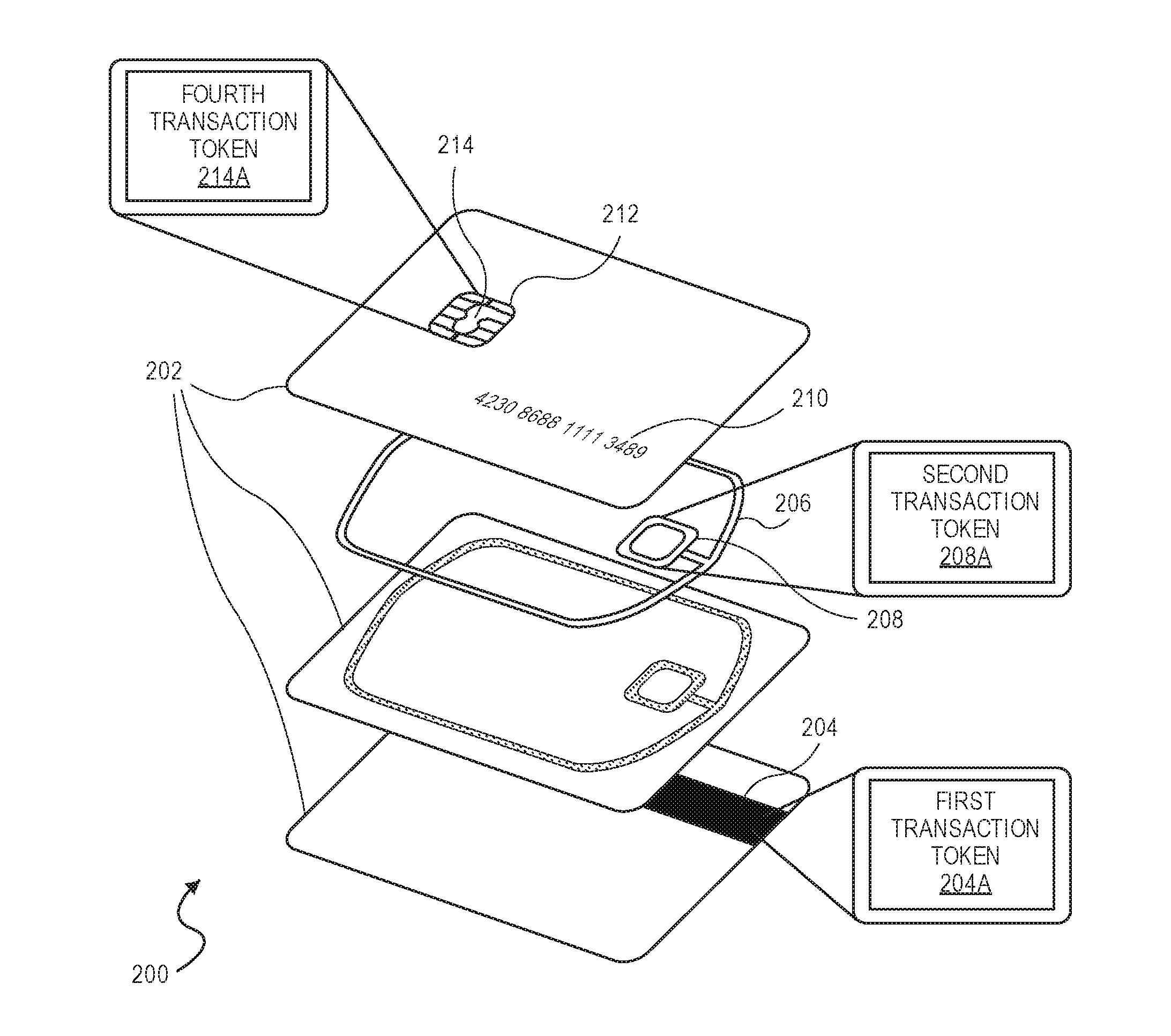

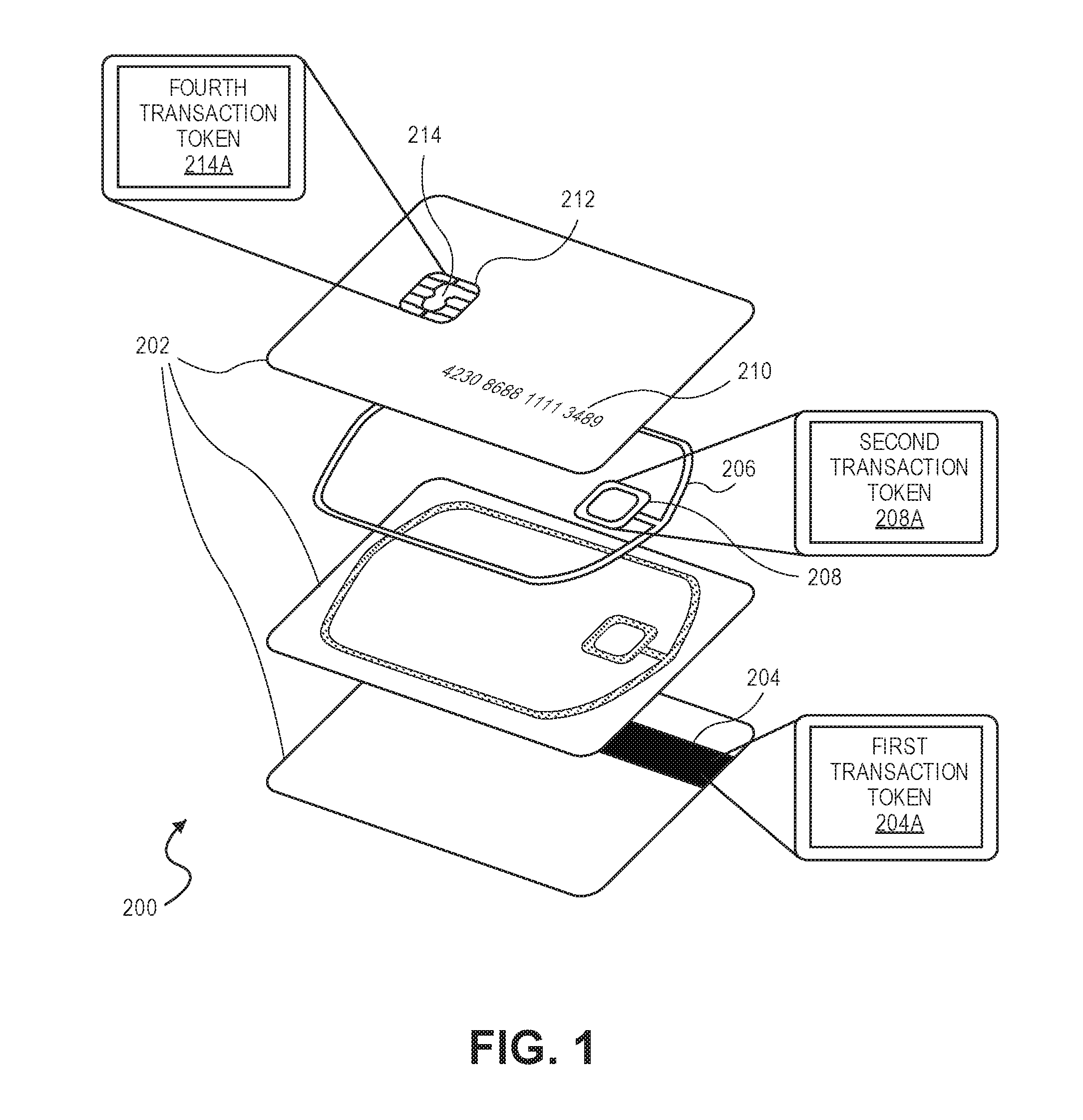

A device stores multiple identifiers meant for specific uses. For example, multiple transaction tokens can reside on different parts of a user device. Each transaction token can be compatible for use with a transaction channel (e.g., contact, contactless, and card-not-present, telephone-order, mail-order, in-app, etc.). A transaction can be terminated based on a transaction token being utilized in an inappropriate transaction channel, which limits the chances that a compromised transaction token can be successfully utilized for fraud. In some cases, the user device may be a transaction card or a mobile phone.

Owner:VISA INT SERVICE ASSOC

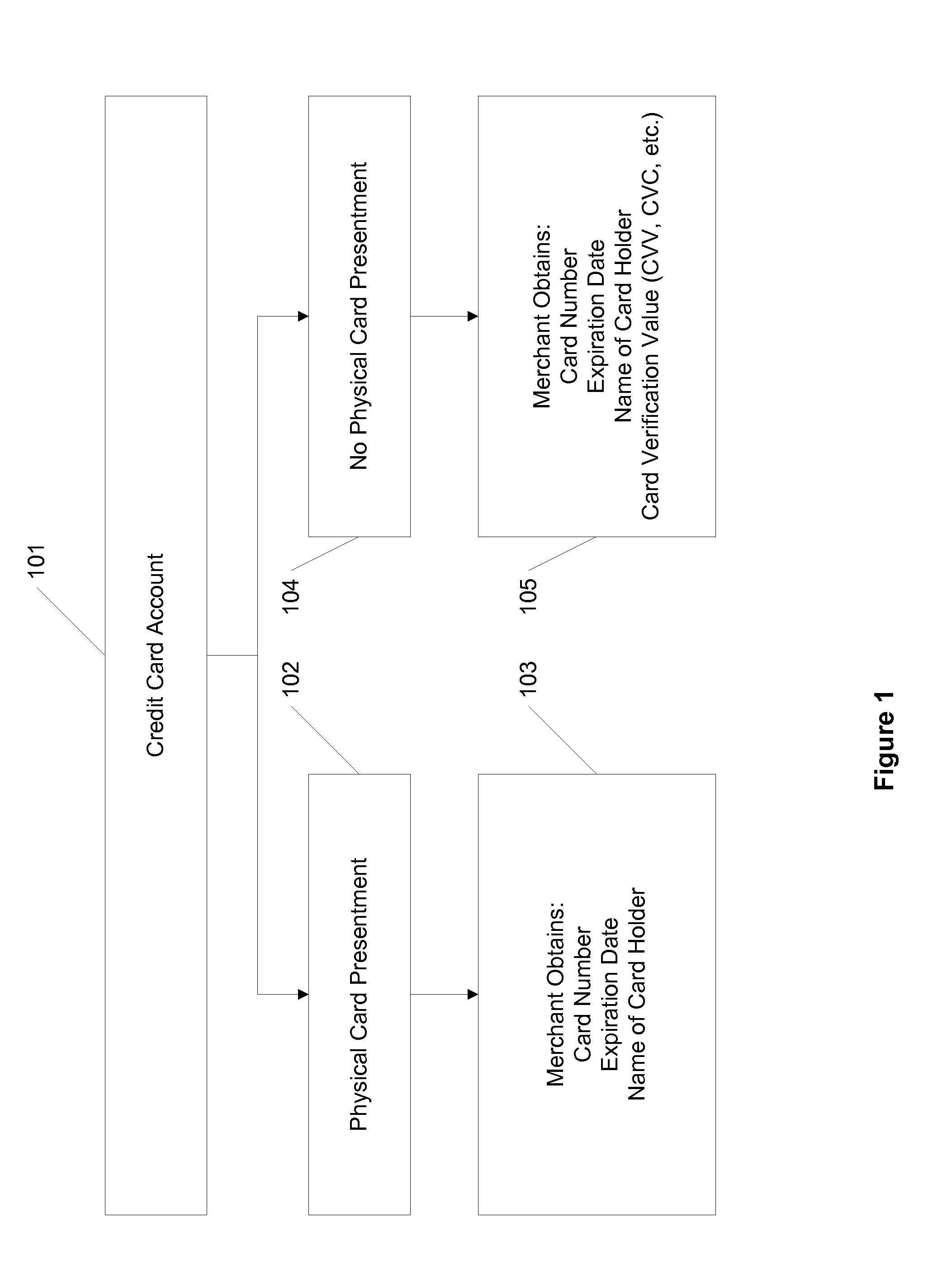

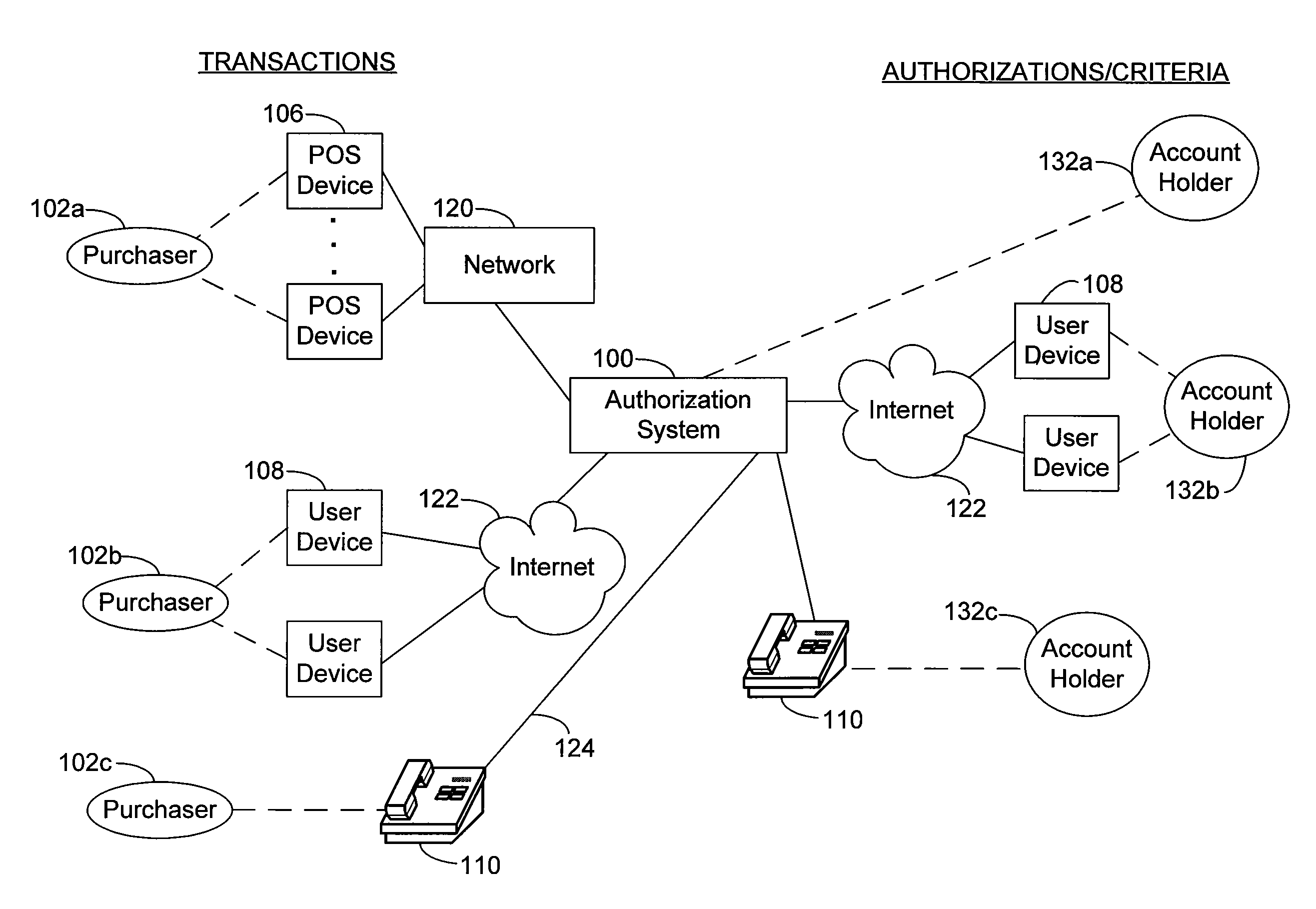

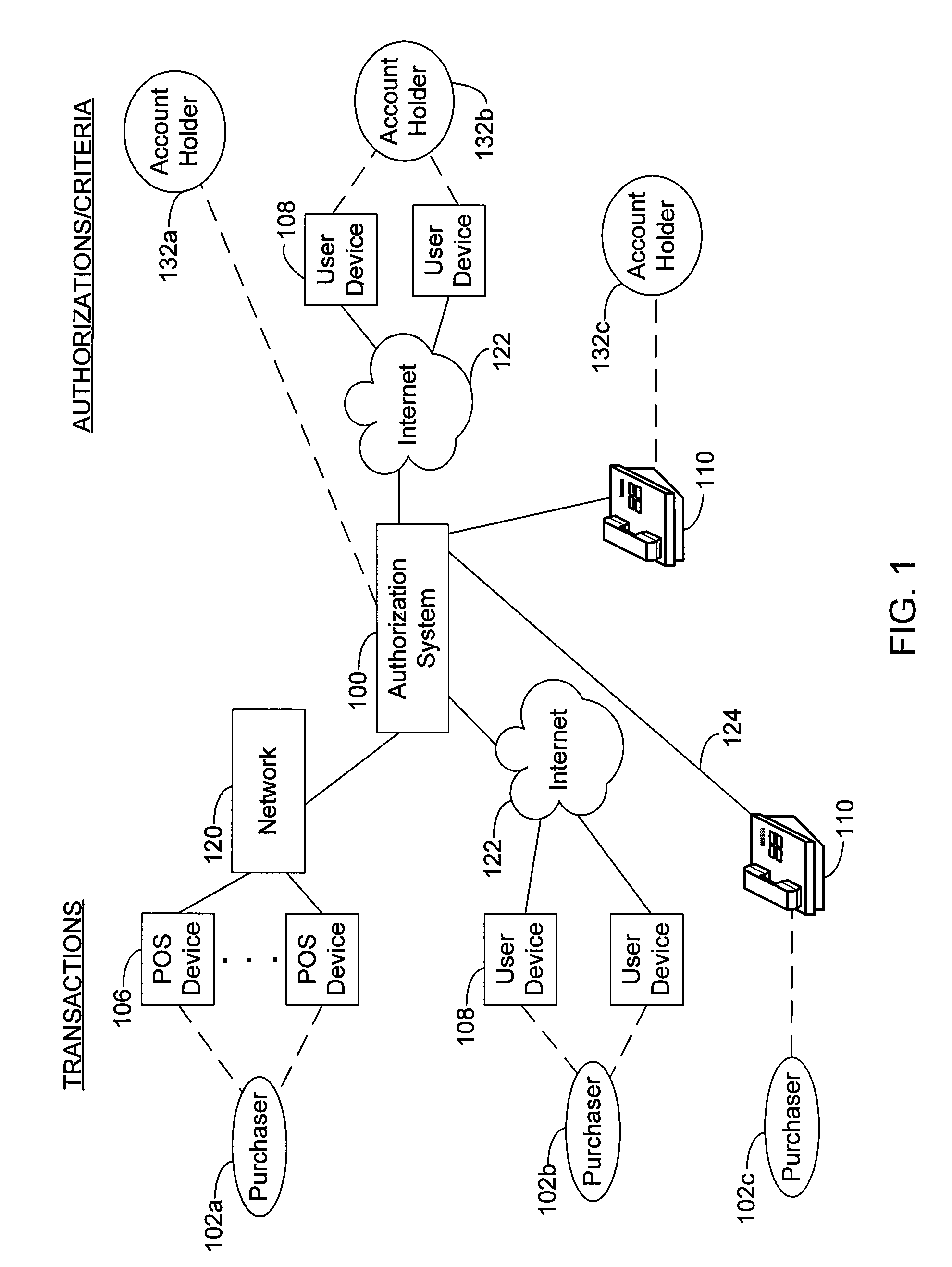

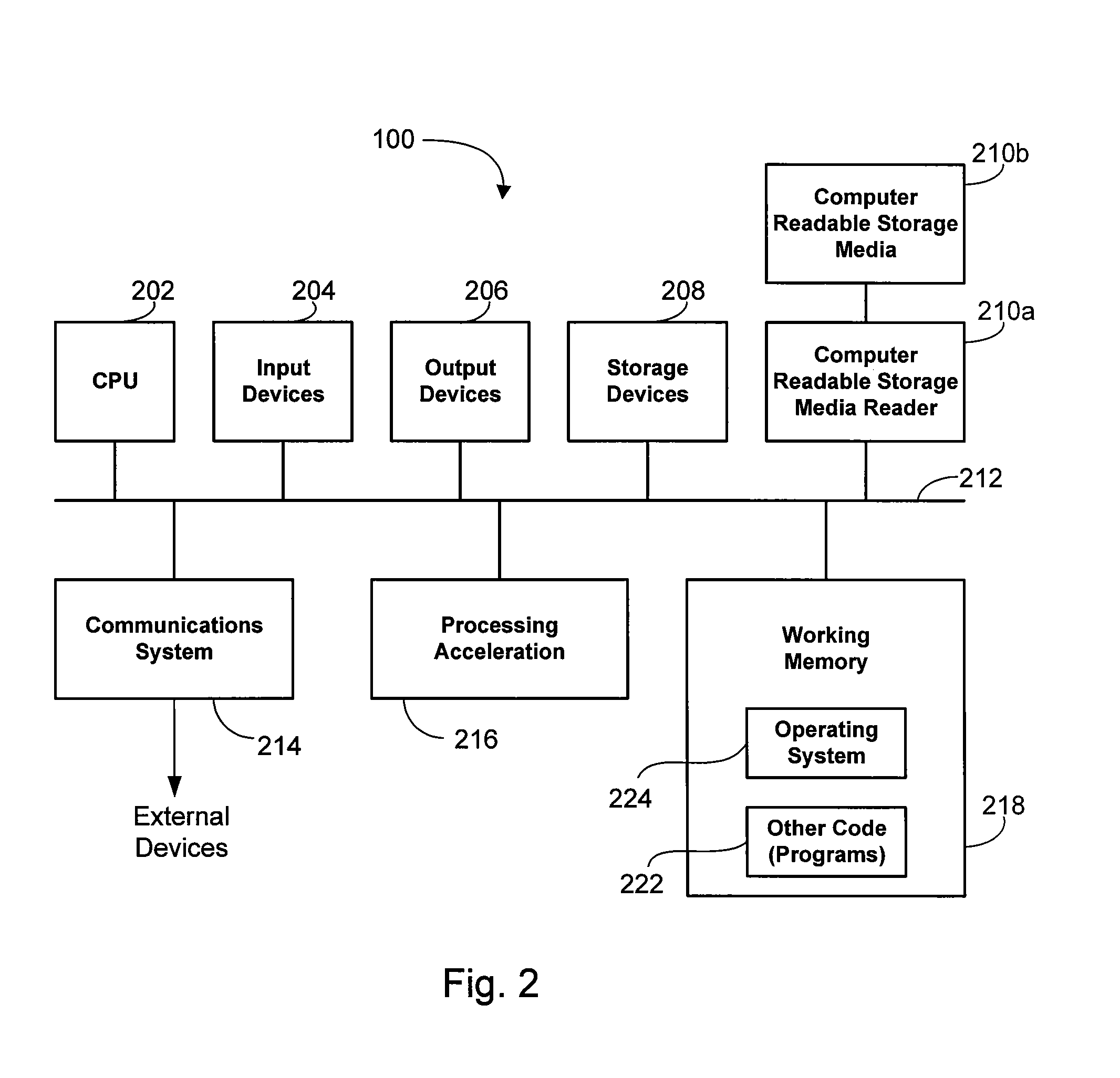

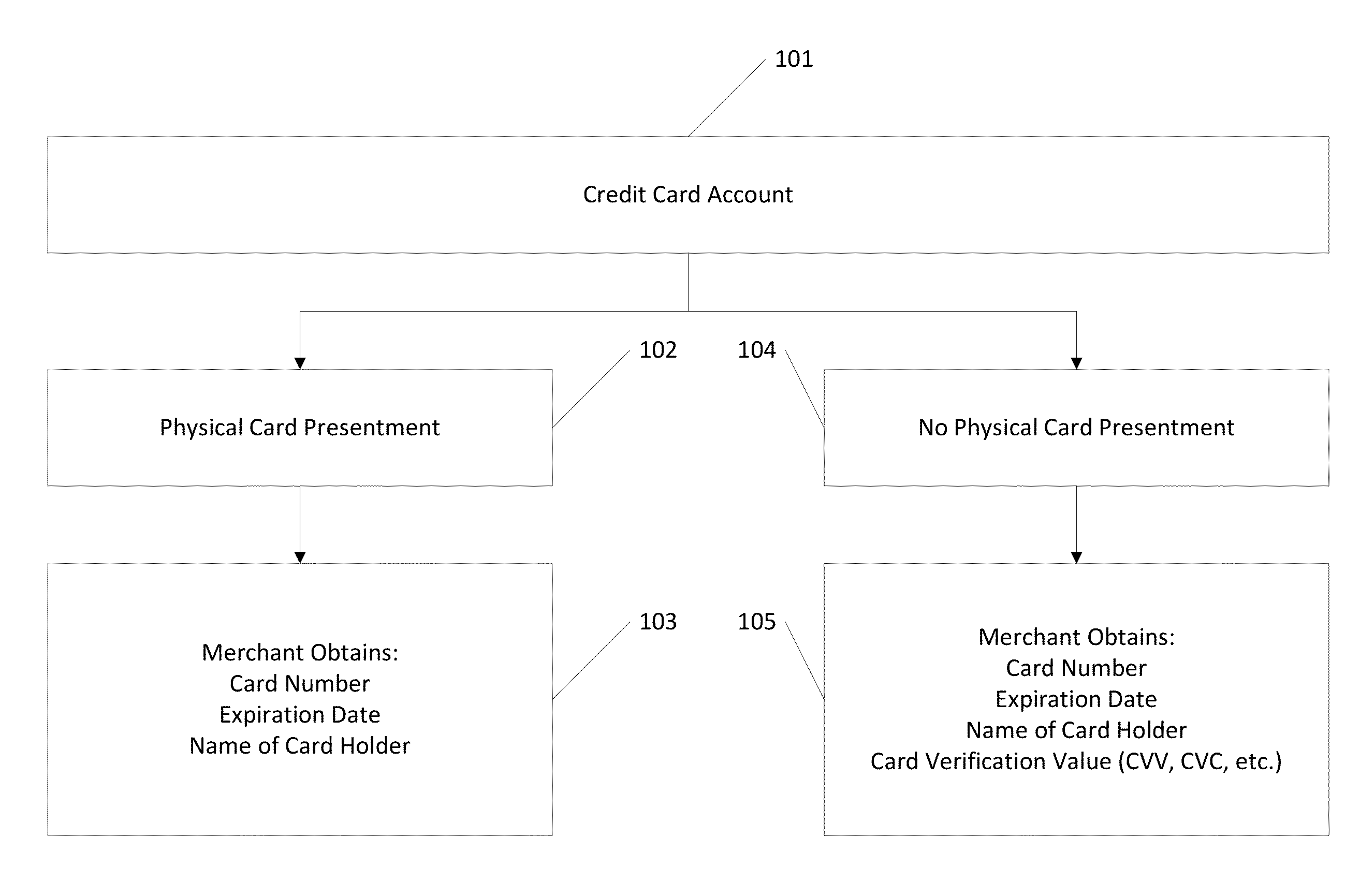

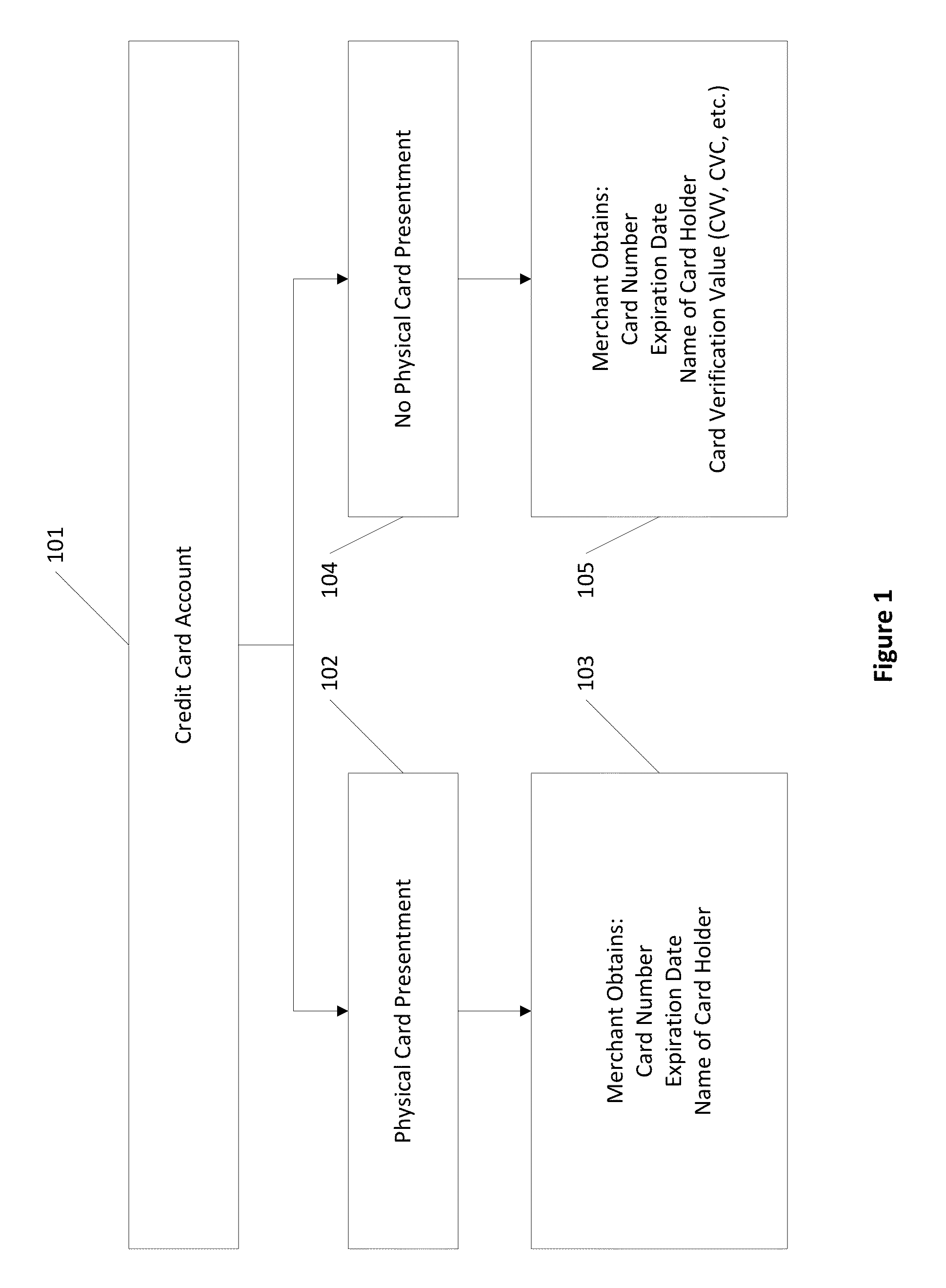

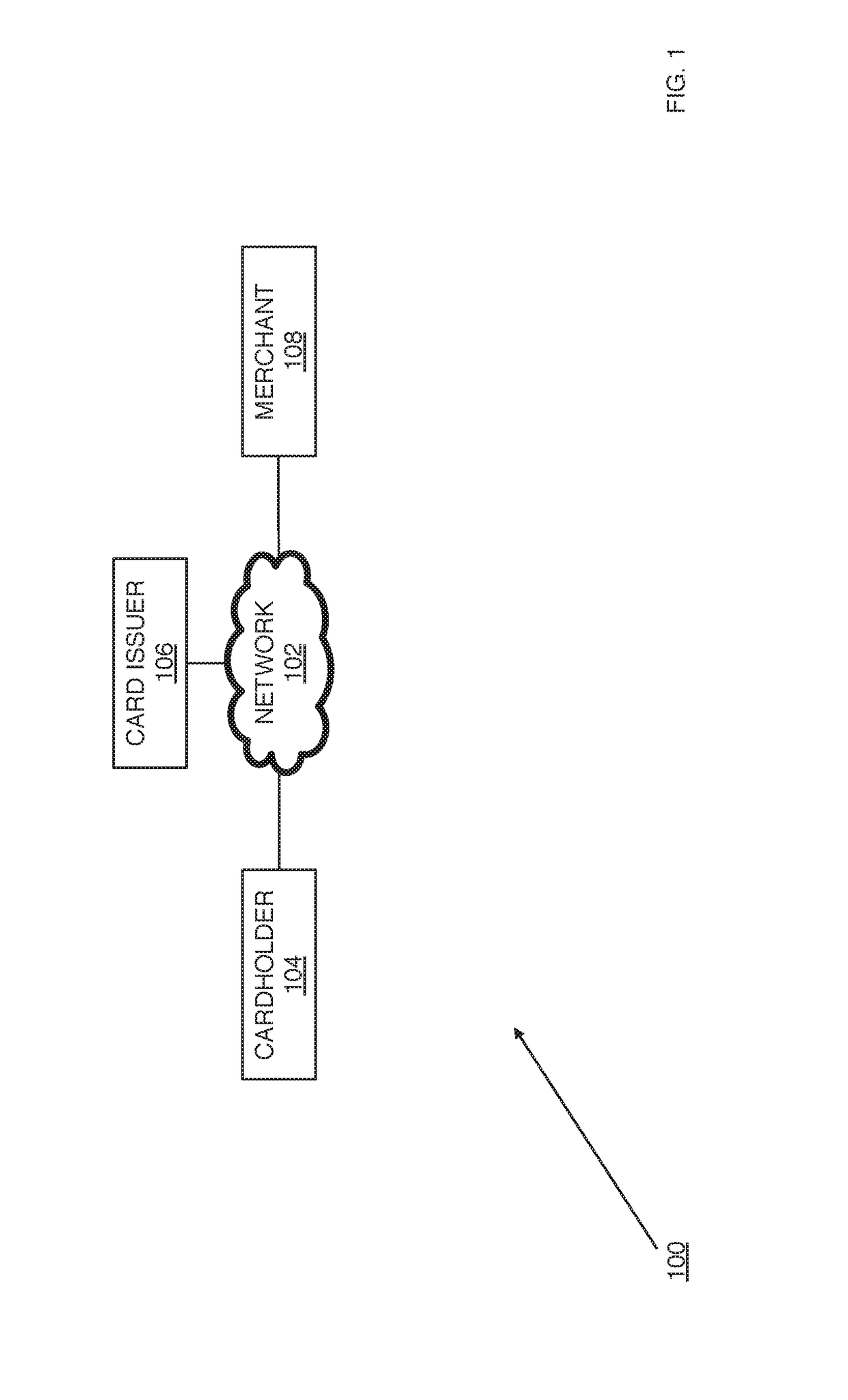

System and method for card not present transactions

InactiveUS20070299774A1Reducing fraudulent “card not presentFinancePayment architectureCredit cardOperating system

An authorizing system used for credit card and similar transactions where the credit card is not physically presented to the merchant (i.e., “card not present” transactions). Authorizing criteria may be selected by the account holder and stored in the authorizing system, for comparison to subsequent “card not present” transactions. The authorizing criteria may include total cumulative transactions amounts for “card not present” transactions during a monthly statement period.

Owner:FIRST DATA

Dynamic Security Code

A system and method for providing card verification values for card-not-present transactions is described. In one example, a user's computing device stores single-use CVVs to be provided from a secure wallet. The secure wallet may be software running on the user's computing device. Alternatively, it may be an external device connectable to the user's computing device, which accesses the external device to obtain the single-use CVV.

Owner:INTERSECTIONS LLC +1

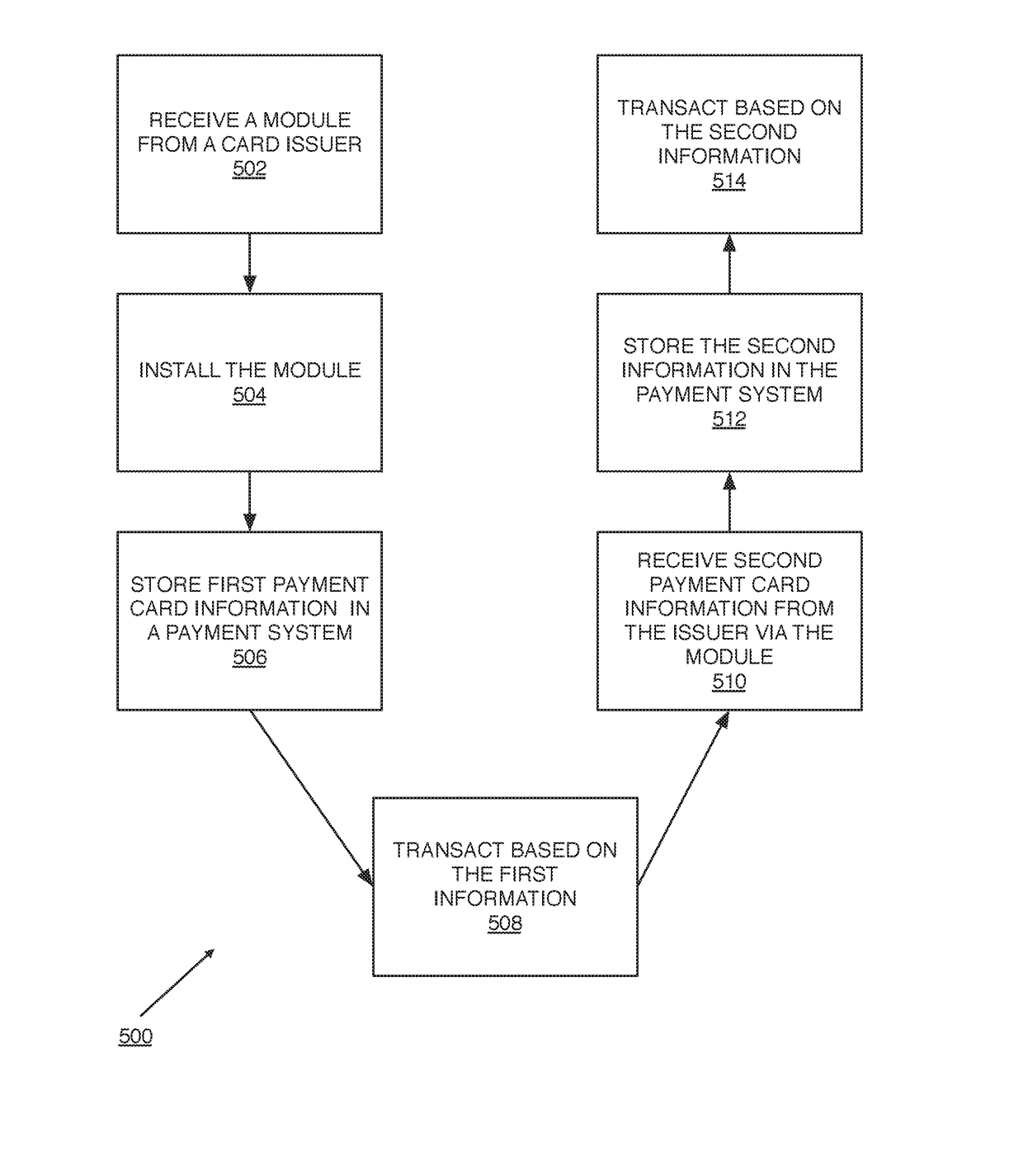

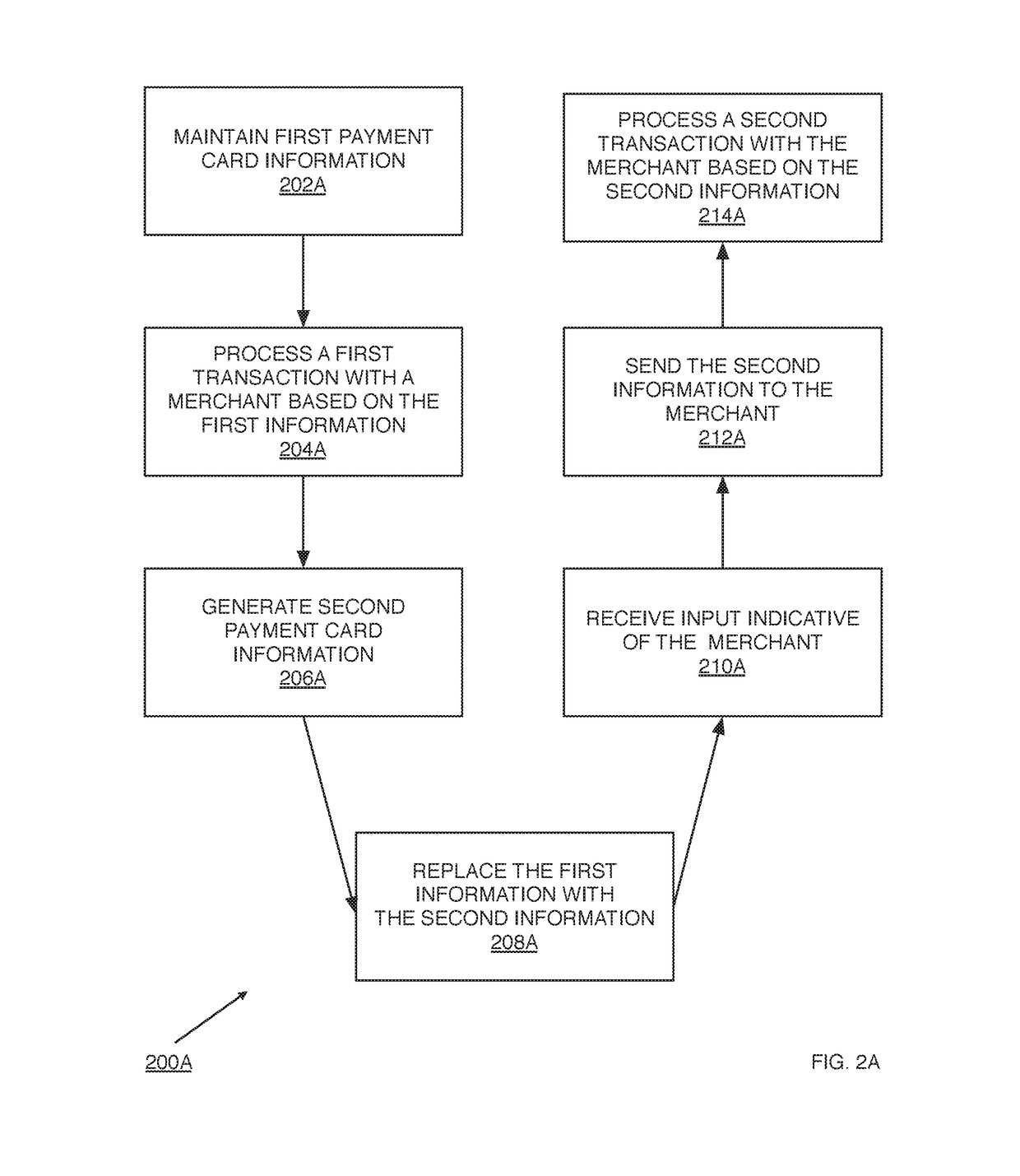

Payment information technologies

A method includes maintaining first payment card information for a cardholder. The method includes processing a first card not present transaction between the cardholder and a merchant. The first transaction based at least in part on the first information. The method includes generating second payment card information for the cardholder. The second information replacing the first information for subsequent use via the cardholder. The method includes receiving an input from the cardholder. The input indicating the merchant. The input based at least in part on the second information replacing the first information. The method includes sending the second information to the merchant based at least in part on the input. The method includes processing a second card not present transaction between the cardholder and the merchant. The second transaction based at least in part on the second information after the sending.

Owner:GREENBAUM BARRY +1

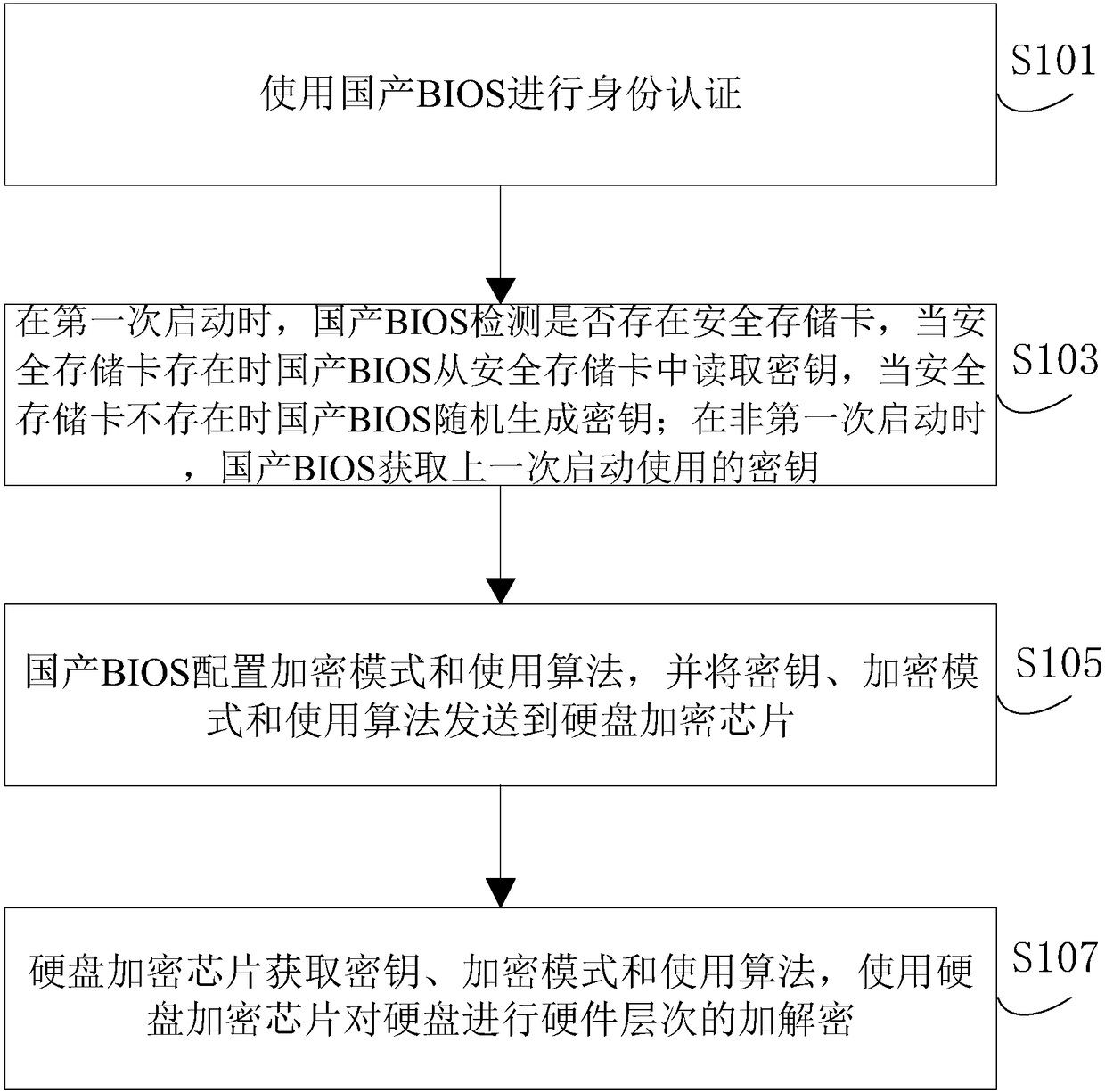

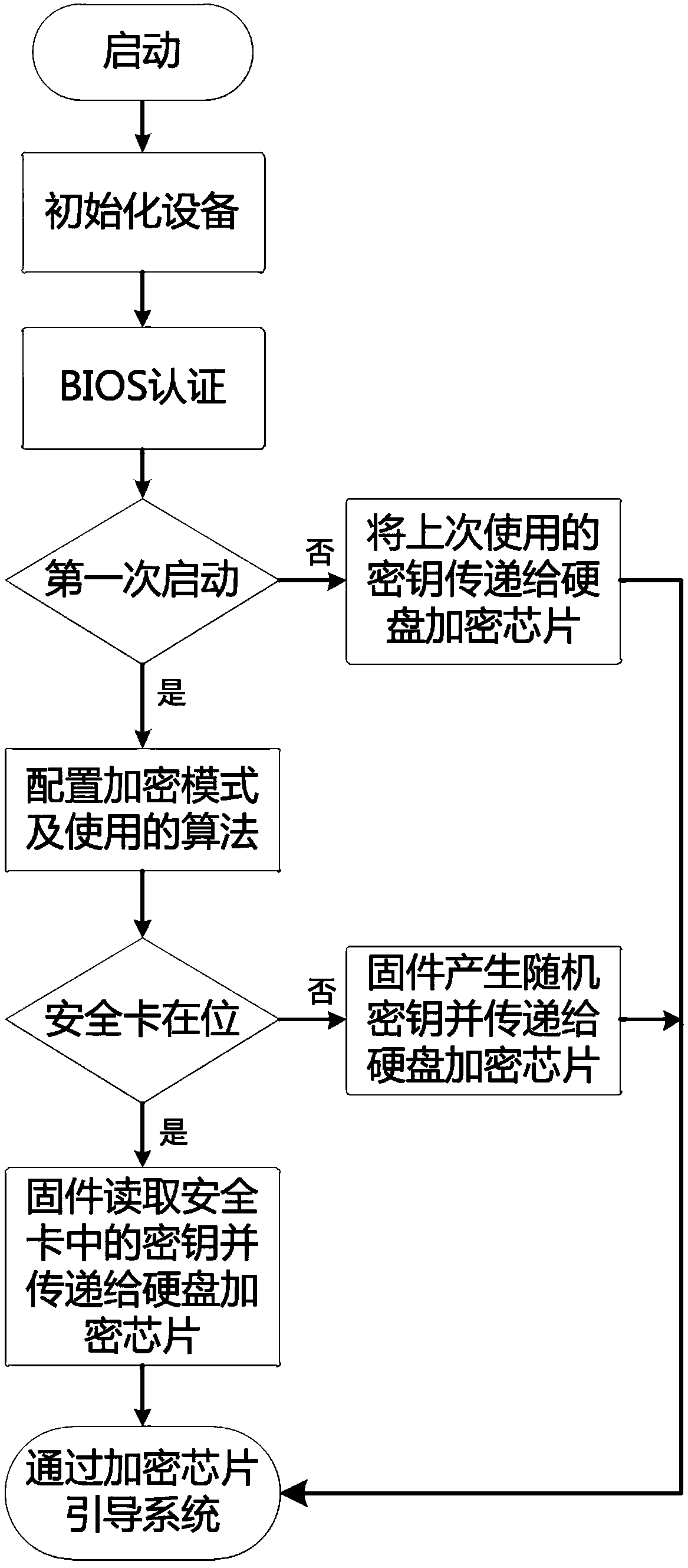

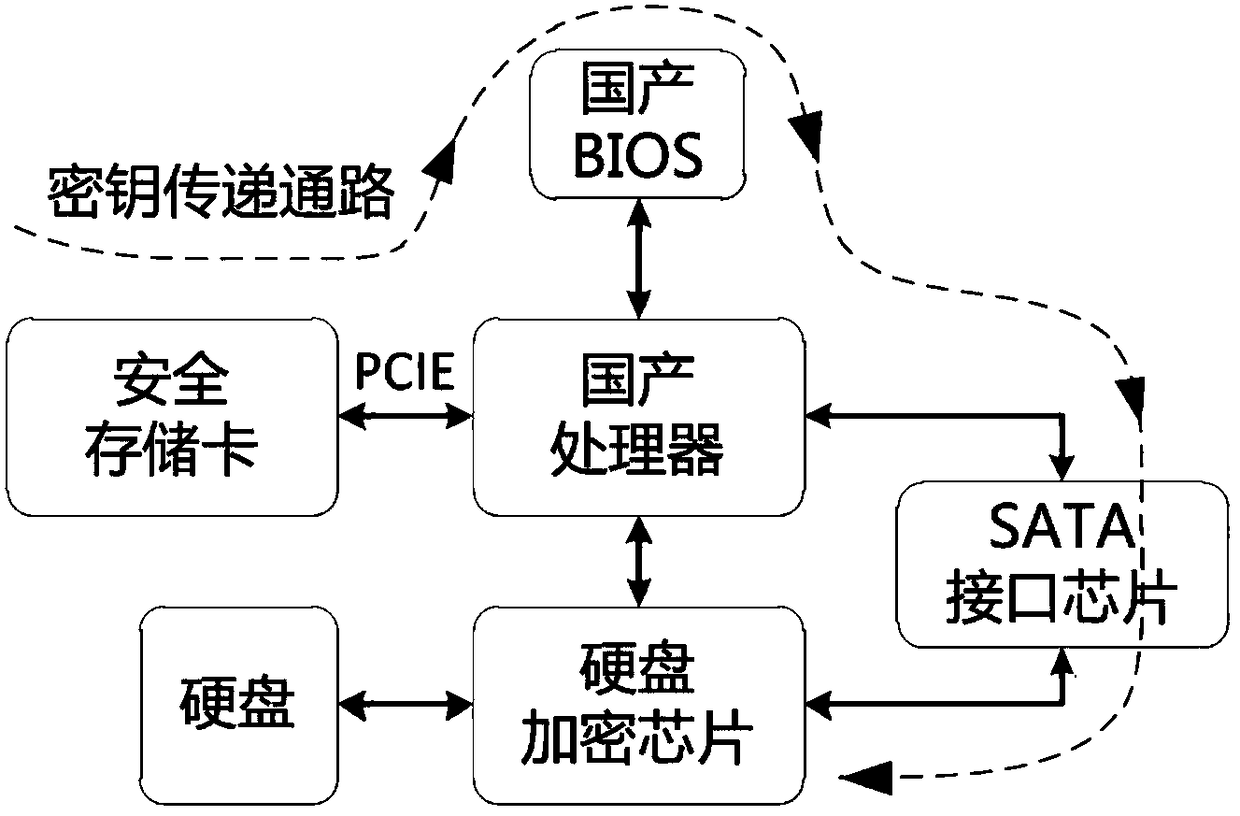

Hard disk encryption method and device

InactiveCN108171067AFast encryptionDigital data protectionInternal/peripheral component protectionBIOSDisk encryption

The invention discloses a hard disk encryption method and device. The method comprises the steps that a domestic BIOS is used to perform identity authentication; during first starting, the domestic BIOS detects whether a secure storage card exists, when the secure storage card exists, the domestic BIOS reads a key from the secure storage card, and when the secure storage card does not exist, the domestic BIOS randomly generates a key; during non-first starting, the domestic BIOS acquires the key used in last starting; the domestic BIOS configures an encryption mode and a use algorithm and sends the key, the encryption mode and the use algorithm to a hard disk encryption chip; and the hard disk encryption chip acquires the key, the encryption mode and the use algorithm, and the hard disk encryption chip is used to perform hardware-level encryption / decryption on a hard disk. Through the hard disk encryption method and device, encryption speed can be increased, the key can be securely stored, and multiple encryption modes can be applied according to needs.

Owner:SHANDONG CHAOYUE DATA CONTROL ELECTRONICS CO LTD

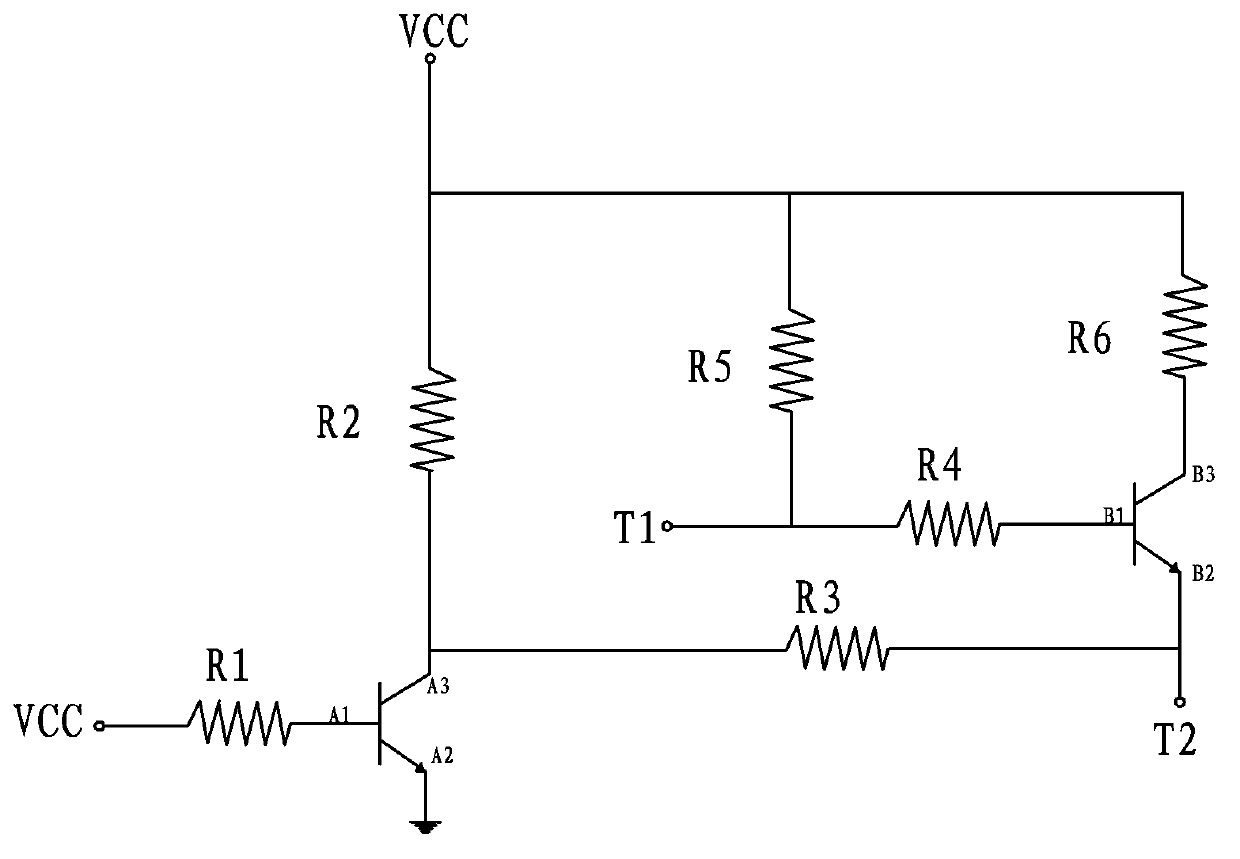

Memory card detection circuit and method

A memory card detection circuit is connected between the input end of a memory card power supply and a memory card detection pin, and comprises a first switch circuit, a second switch circuit and an output detection pin; the input end of the first switch circuit is connected with the input end of the memory card power supply, and the first switch circuit is used for detecting whether the memory card power supply supplies power; the input end of the second switch circuit is connected with the output end of the memory card detection pin, and the second switch circuit is used for detecting whether the memory card exists; the output detection pin is connected with the output end of the first switch circuit and the output end of the second switch circuit, and is used as the output detection pin for detecting whether a memory card has a signal. The memory card detection circuit and method can detect a memory card inexistence state whether the memory card is really pulled out or the memory card power supply is disconnected, and realize the memory card detection and power failure detection, so as to solve the problems of memory card existence and memory card power failure; and a basis is provided for a next operation of the system by adopting the same detection pin, software is not required to participate in judgment, and system resources are saved.

Owner:XIAMEN YAXON NETWORKS CO LTD

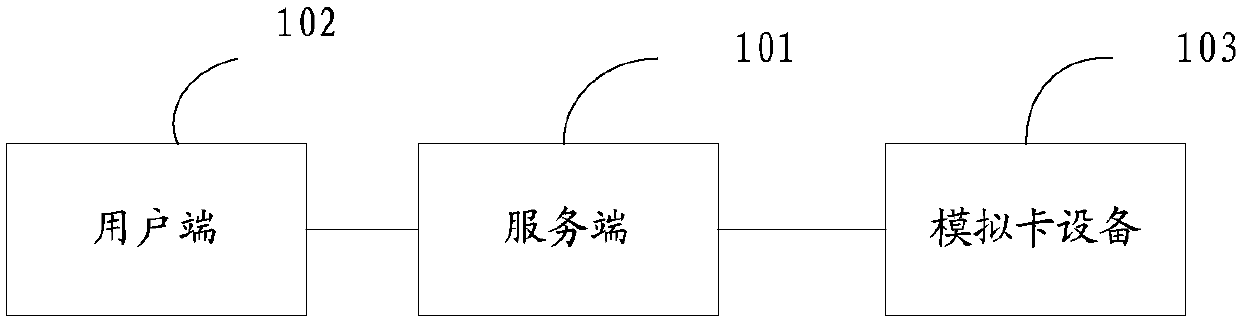

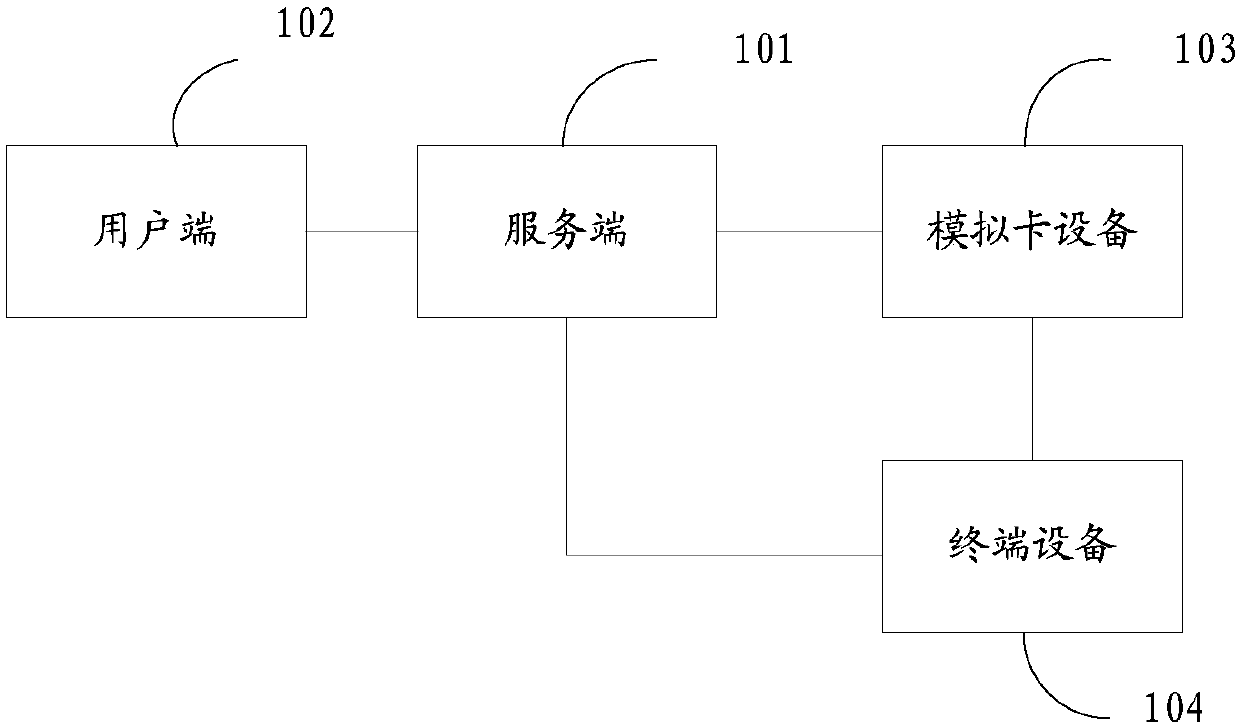

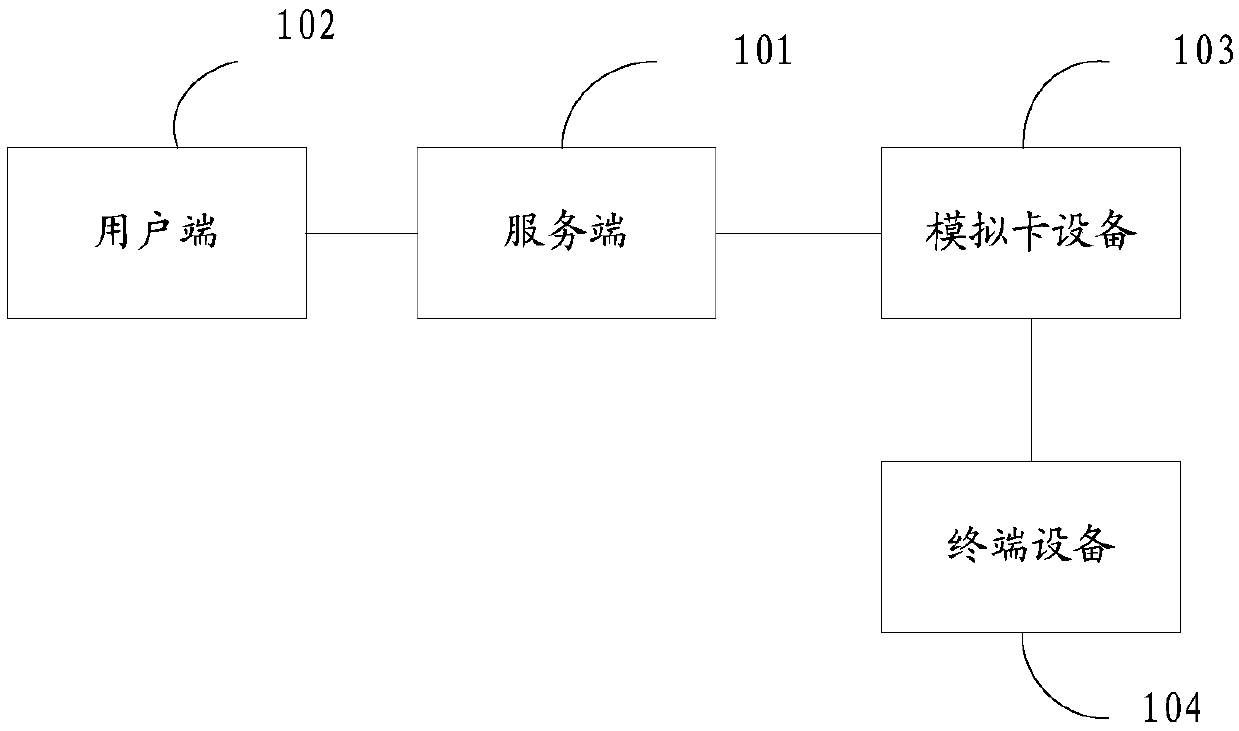

Card-not-present interactive system and analog card equipment

ActiveCN109547554ASatisfy personalizationTransmissionShort range communication serviceTerminal equipmentComputer terminal

The invention discloses a card-not-present interactive system and analog card equipment. The system comprises a server and a user terminal and analog card equipment that are separately connected withthe server. The user terminal determines any to-be-downloaded analog card application of the analog card equipment, and sends a download request of any analog card application to the server; the server sends, based on the download request, a download instruction for any analog card application to the analog card equipment; the analog card equipment downloads, based on the download instruction, aninstallation file corresponding to any analog card application from the server, installs any analog card application based on the installation file and acquires user registration information corresponding to any analog card application; and the analog card equipment interacts with terminal equipment corresponding to any analog card application, so as to process services based on the user registration information corresponding to any analog card application and equipment interaction information of terminal equipment corresponding to any analog card application. Through adoption of the card-not-present interactive system and analog card equipment, card-not-present interaction based on user demands is realized.

Owner:北京红枣科技有限公司 +2

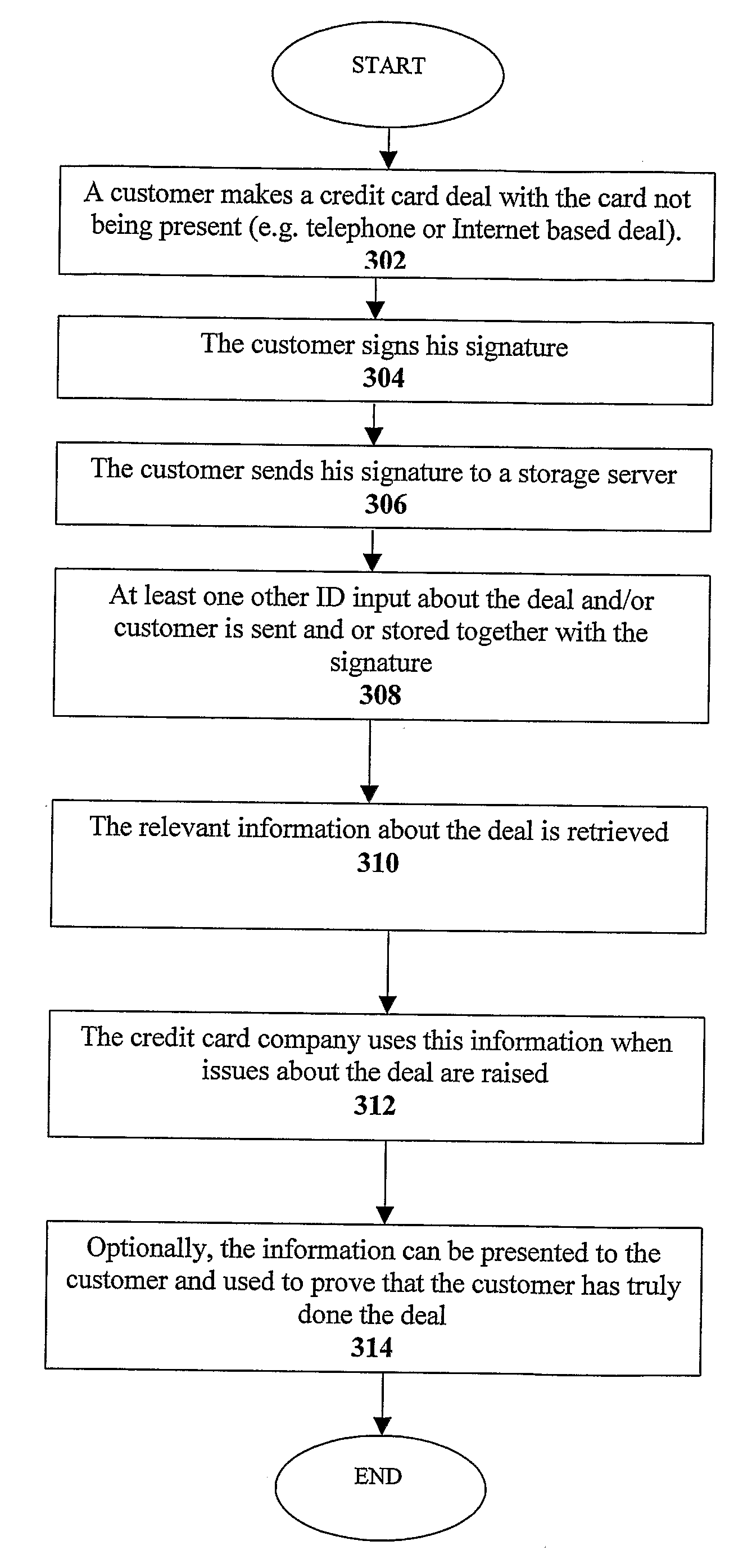

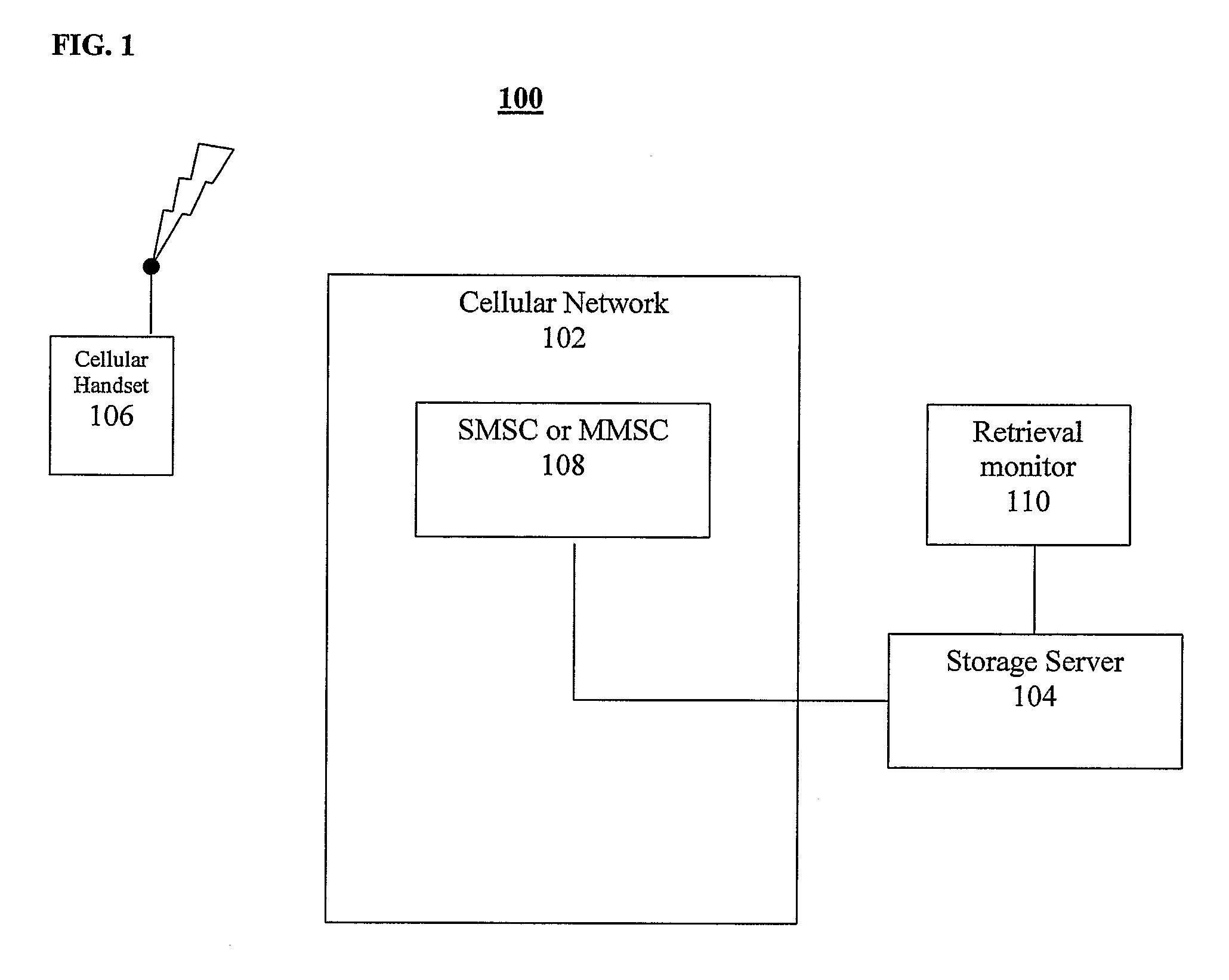

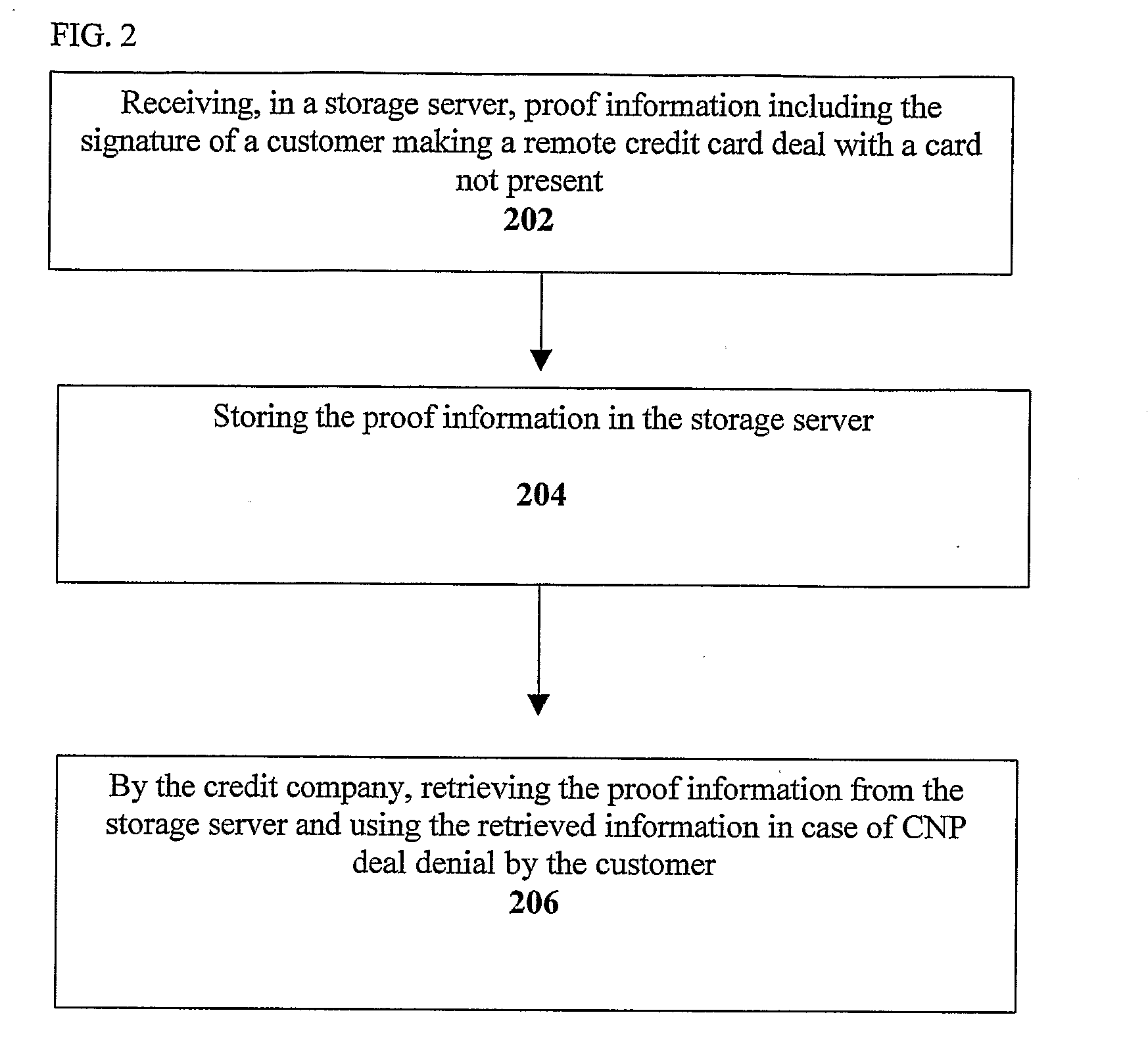

Card-not-present fraud prevention

InactiveUS20100223193A1Preventing CNP fraudPrevent fraudFinancePayment circuitsDatabaseCard not present

A system and method for preventing card not present (CNP) fraud by a customer performing a CNP transaction with a transaction provider. The customer signature and at least one added identification input related to the transaction are provided to and stored on a dedicated server. The customer signature and added ID input are then retrieved by the transaction provider in case the customer denies the transaction, to prove that the transaction was valid.

Owner:WRITEPHONE COMM

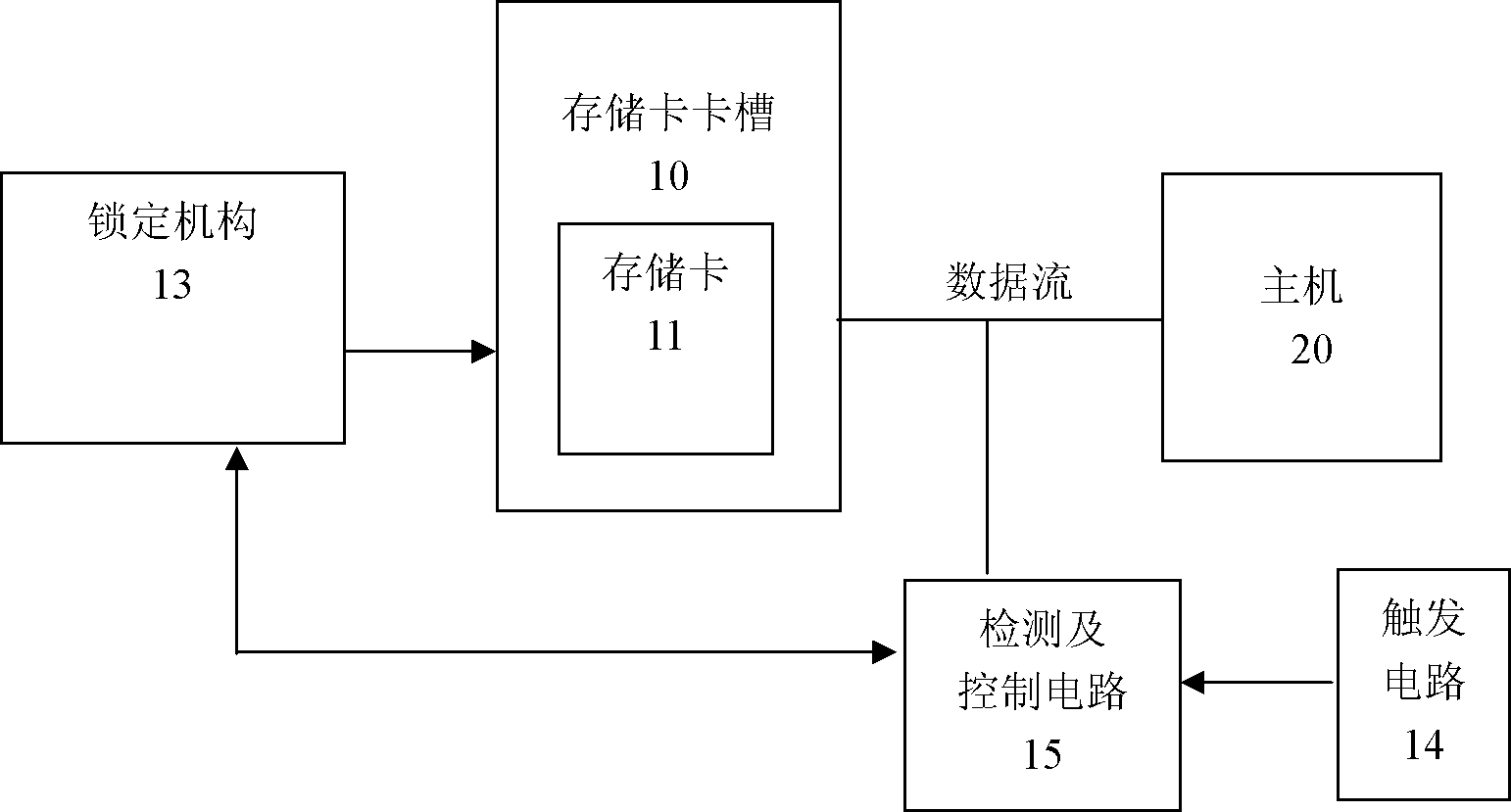

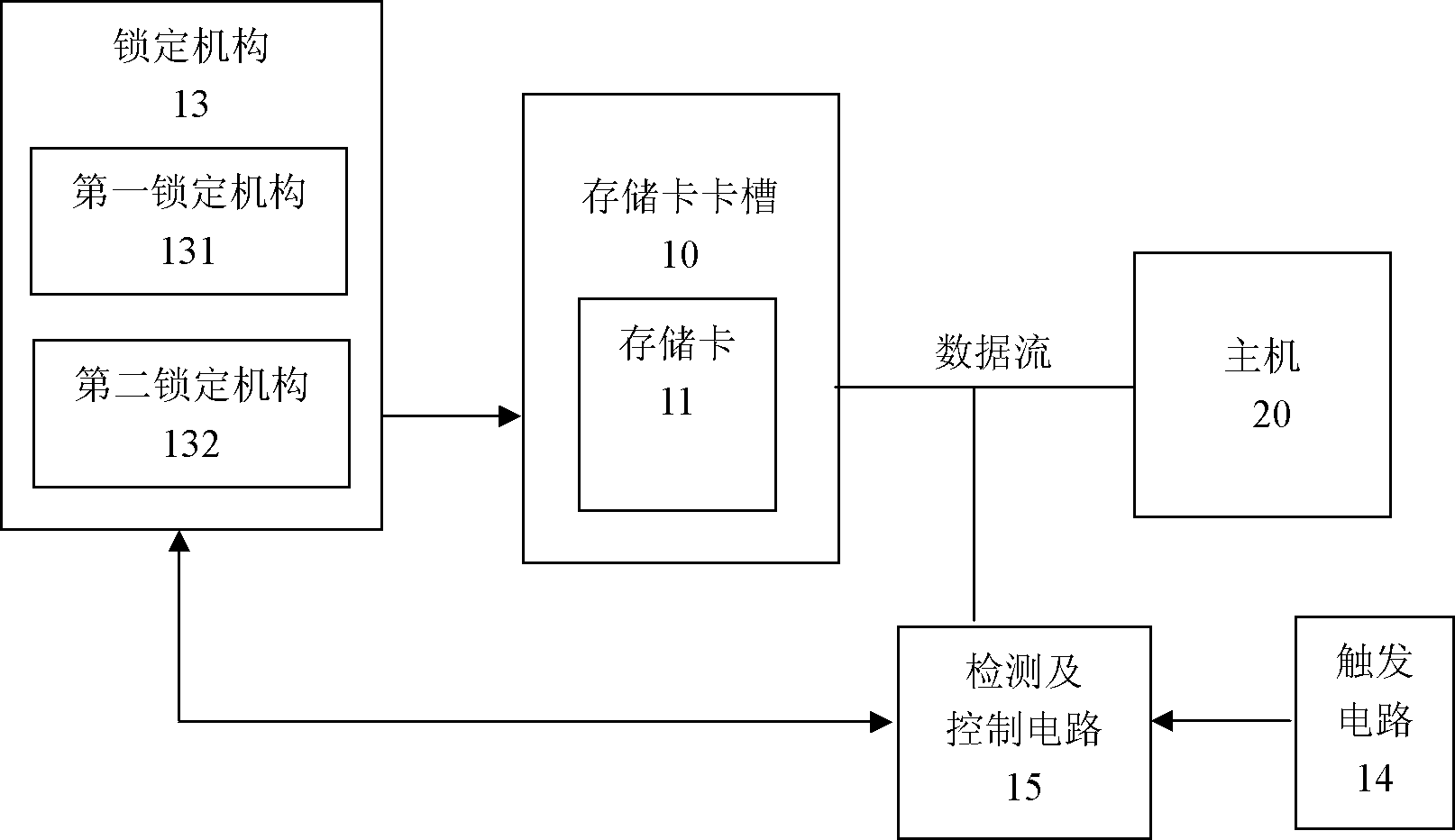

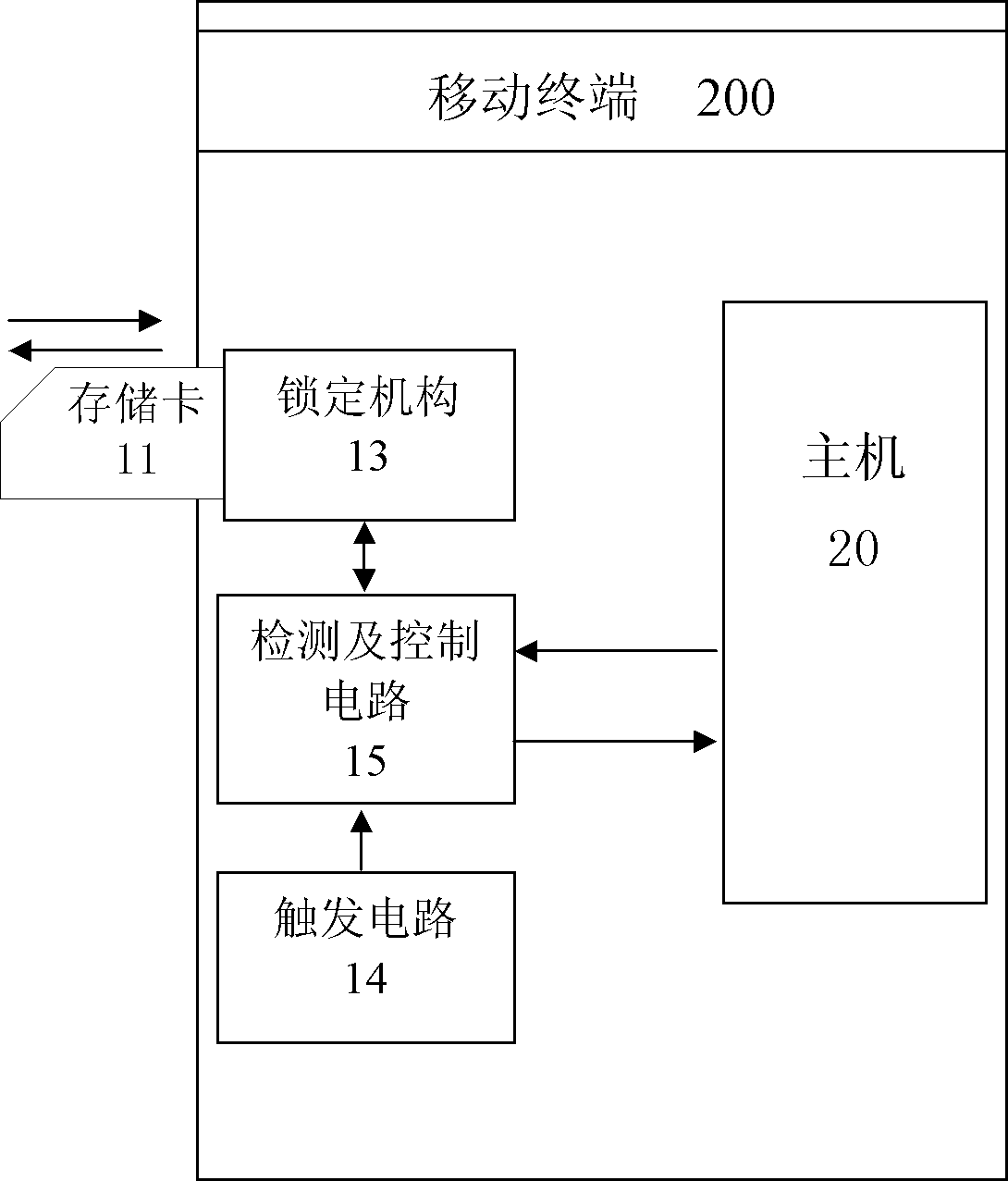

Storage card hot plug control method and device

ActiveCN103257906ALock releaseImprove experienceRedundant hardware error correctionComputer hardwareLocking mechanism

The invention relates to a storage card hot plug control method and device. The control method includes step 100 receiving a card pulling command requesting for pulling out a storage card; step 110 detecting whether reading-writing operation exists in the storage card; step 120 keeping the locking state of the storage card by a locking mechanism on yes judgment and step 130 removing the locking state of the storage card by the locking mechanism on no judgment. When a mobile terminal receives the card pulling command, a detection and control circuit is utilized to detect whether the reading-writing operation is conducted on the storage card. When the reading-writing operation exists, the circuit controls the locking mechanism to enable the storage card to be kept at the locking state, and locking of the storage card is removed when the reading-writing operation does not exist in the storage card. The method and device avoids severe results of crash, data loss, system collapse and the like caused by the fact that a user cannot judge whether the storage card is in the reading-writing state and directly pulls the storage card from a card slot, and simultaneously brings good experience to the user.

Owner:YULONG COMPUTER TELECOMM SCI (SHENZHEN) CO LTD

Systems and methods for correction of information in card-not-present account-on-file transactions

In one aspect, a method for processing a card-not-present account-on-file transaction is provided. The transaction involves a cardholder using payment card information stored by a merchant. The method includes receiving an authorization request message for the transaction, the authorization request message received at a payment network from an acquirer associated with the merchant and receiving an authorization response message, the authorization response message received at the payment network from an issuer. The authorization response includes a denial indicator indicating that the transaction has been denied. The method further includes querying a database coupled to the payment network to determine whether the database includes updated payment card information for a payment card associated with the transaction. The method additionally includes transmitting the updated payment card information associated with the payment card account identifier associated with the transaction to the acquirer for the acquirer to communicate to the merchant.

Owner:MASTERCARD INT INC

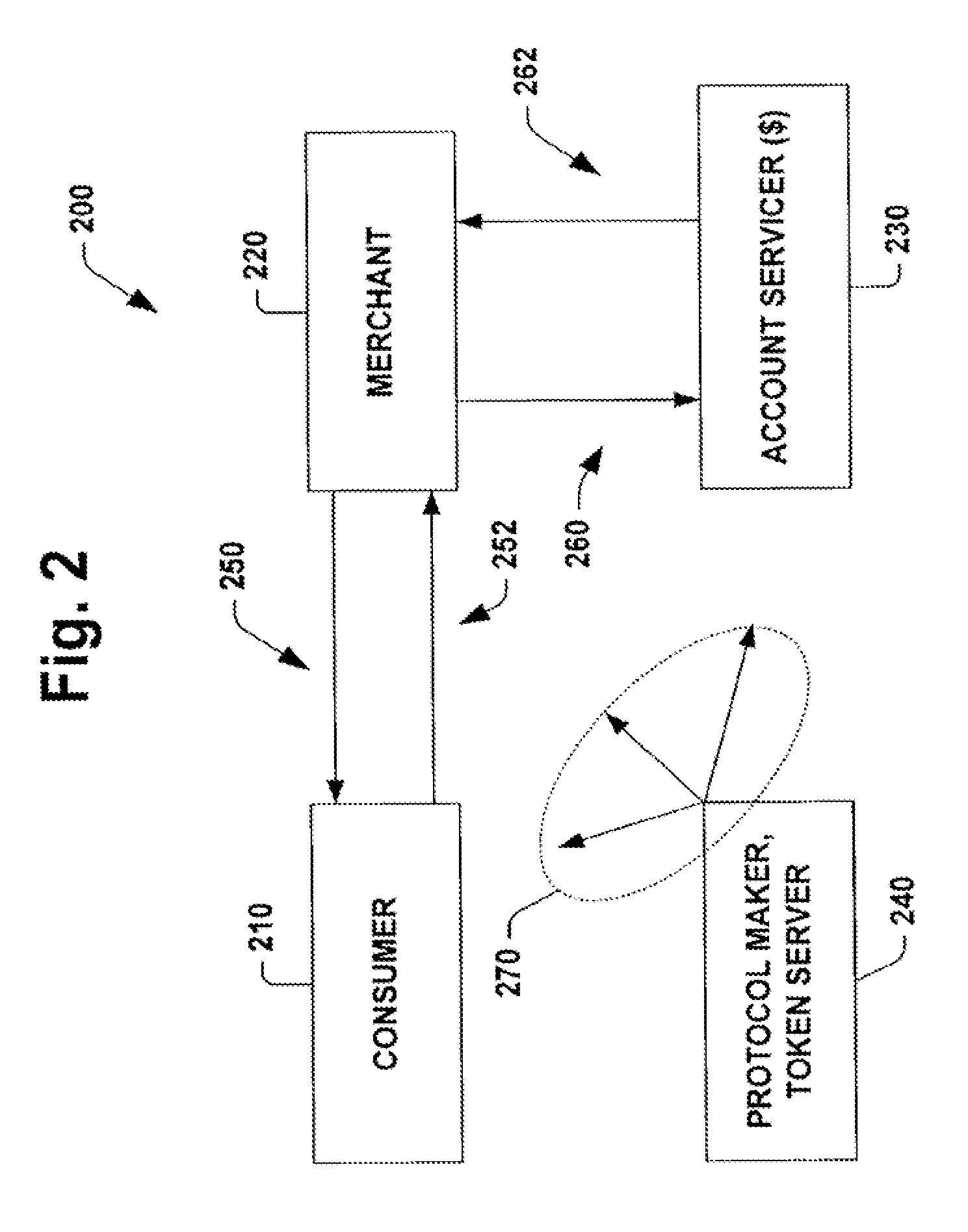

Late binding token in system and method for verifying intent in a card not present transaction

InactiveUS20120123947A1Easy to createPrecise positioningBilling/invoicingProtocol authorisationClient-sideProtocol for Carrying Authentication for Network Access

A system for verifying intent in a card not present transaction is provided. The system includes a late binding token that is distributable to consumers without necessarily being bound to an account. The system also includes a client software that locates a token server configured to facilitate managing and communicating with the late binding token. The system also includes a protocol concerning how to build a verifiably secure structured proposal that carries an offer to the consumer through the client software.

Owner:JONES THOMAS C

Method for Providing Secured Card Transactions During Card Not Present (CNP) Transactions

InactiveUS20160335630A1Reducing fraudulent transactionProtocol authorisationComputer hardwareCredit card

During a card not present (CNP) transaction the user is required to provide more information which includes a two-way handover during transaction processing, merchant options in choosing these steps, security measures in storing information, and retrieving information to fight charge backs. APIs are provided to merchants to integrate with existing transaction processing software the supply sign off option information to the API. Merchants can sign off either prior to or after the transaction processing. Based on the sign off option, the smart phone app displays the steps required to complete the now enhanced sign off process. For the first sign off option, the user must first scan the credit card, then scan a photo id, and then sign the transaction. For the second sign off option, the user has to scan the credit card and sign the transaction. For the third sign off option, the user must sign the transaction.

Owner:KUMAR GOPESH

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com