Patents

Literature

74 results about "Direct Payments" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

The Direct Payments scheme is a UK Government initiative in the field of Social Services that gives users money directly to pay for their own care, rather than the traditional route of a Local Government Authority providing care for them. The Cabinet Office Strategy Unit calls direct payments "the most successful public policy in the area of social care".

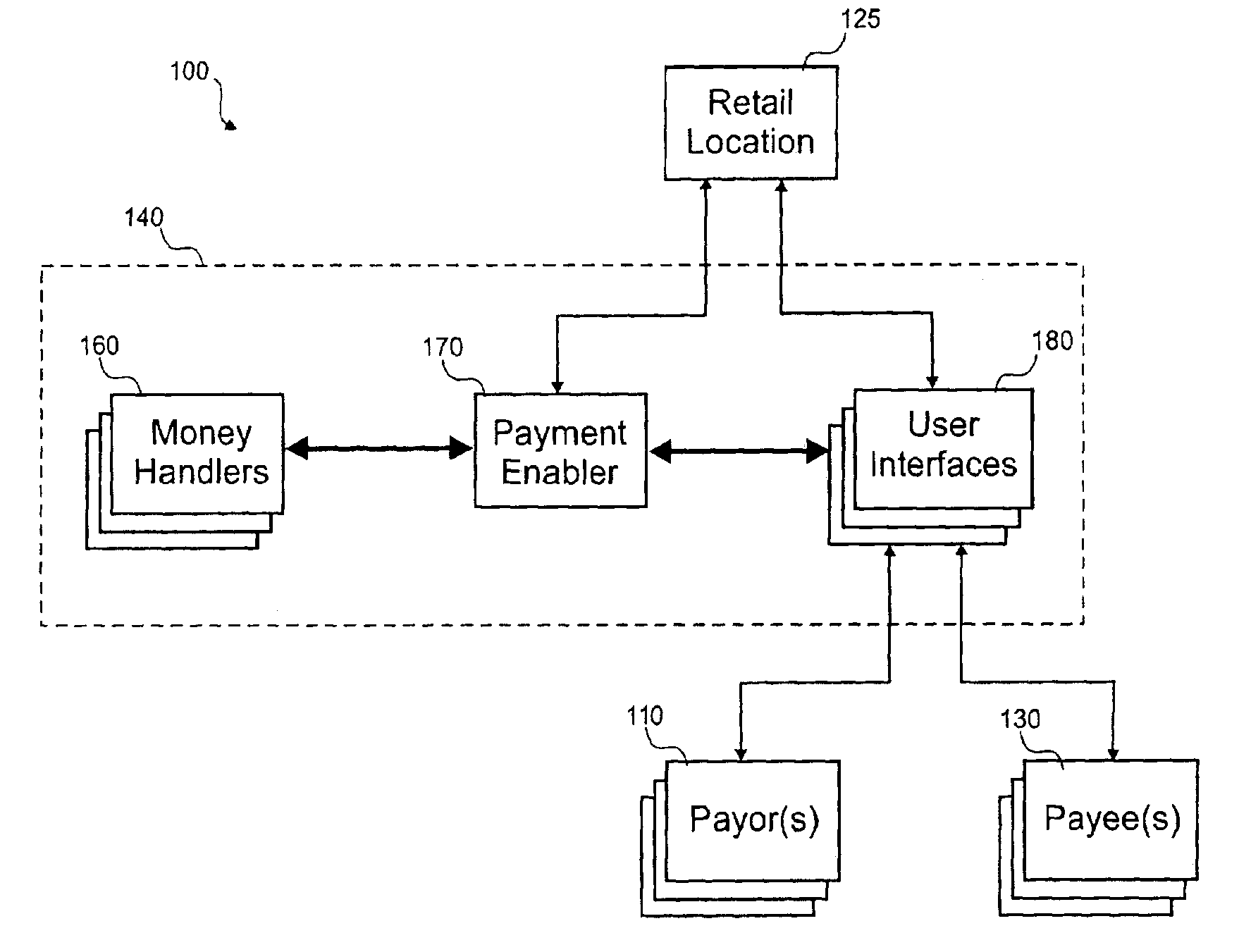

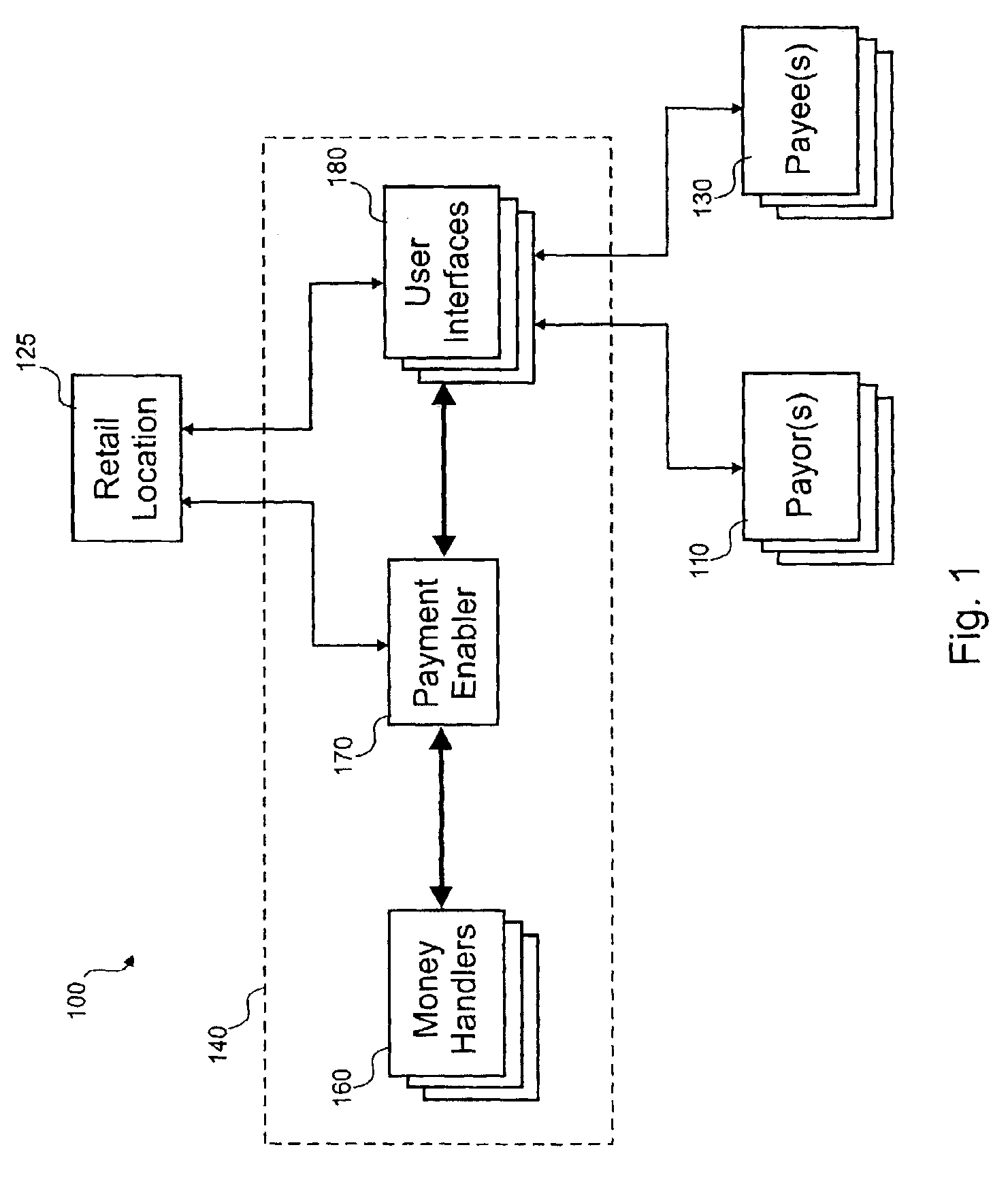

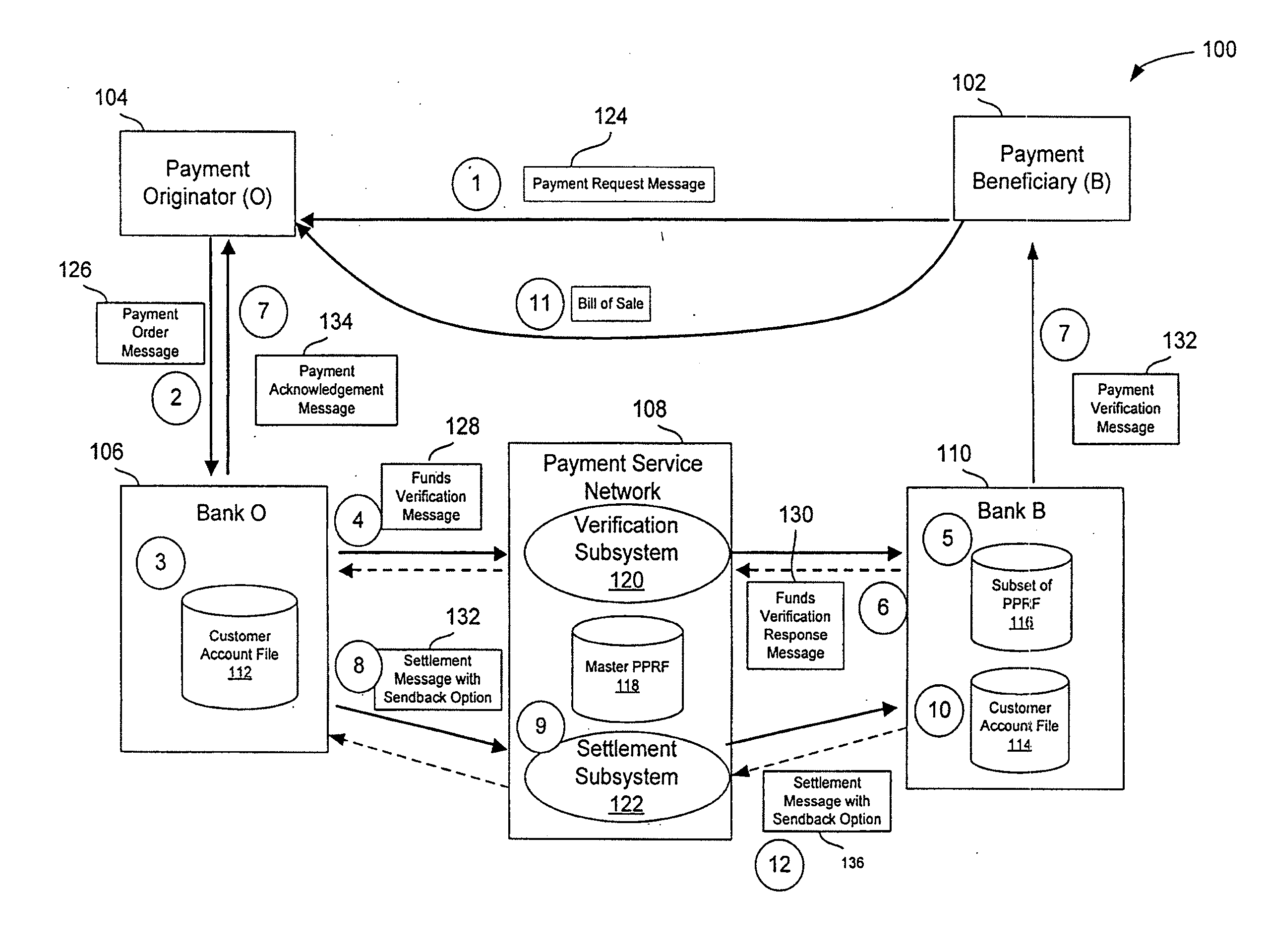

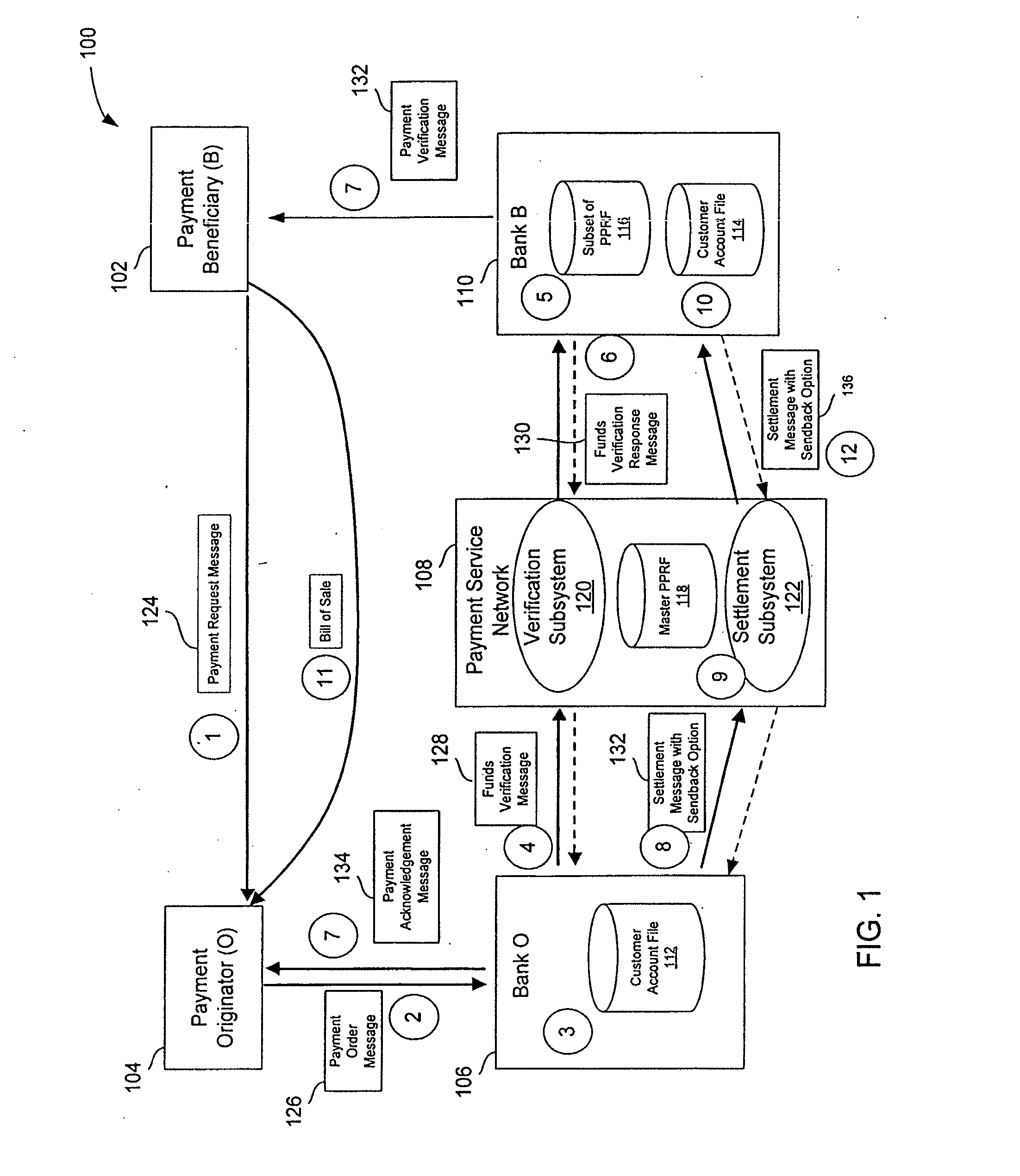

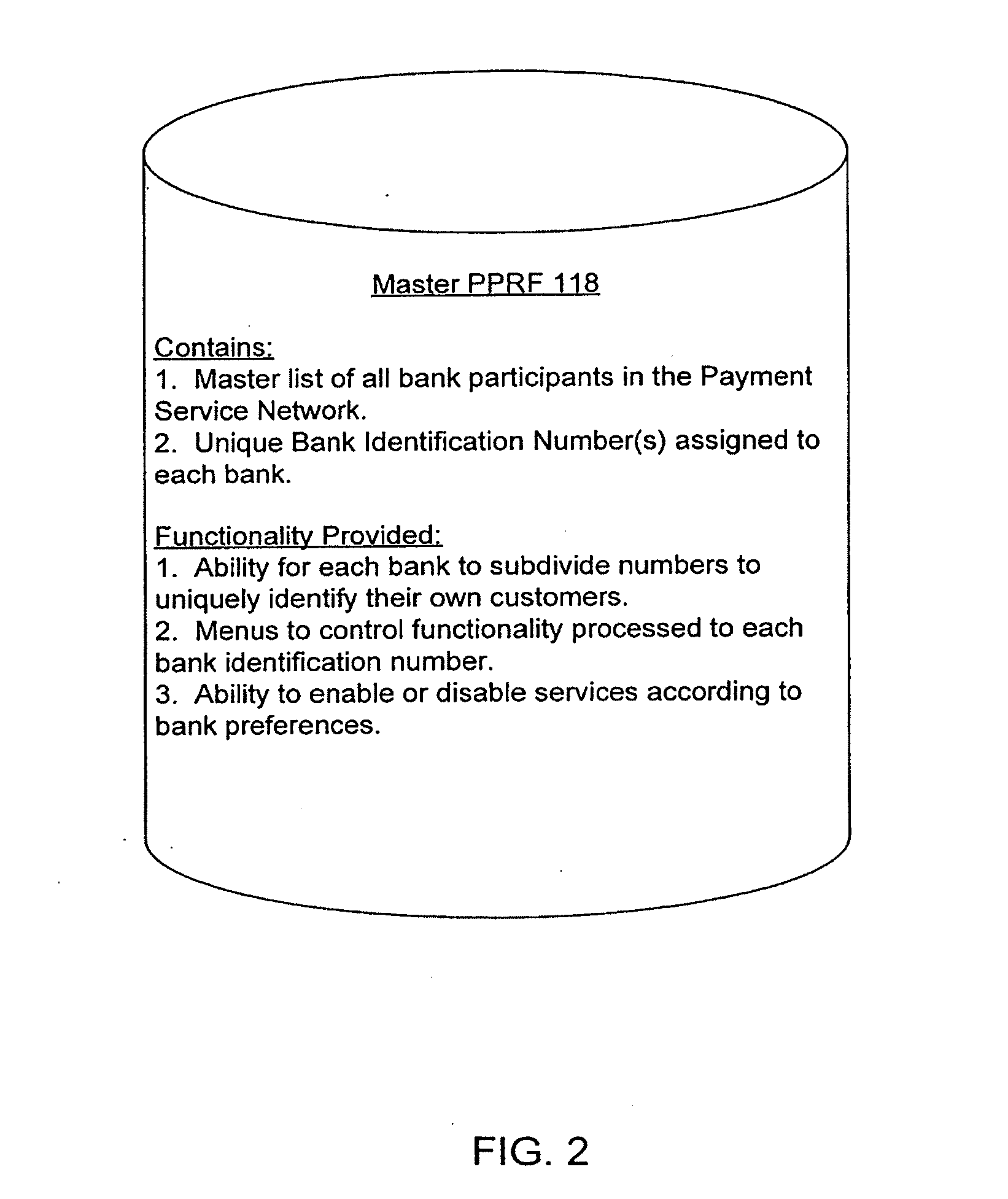

Buyer initiated payment

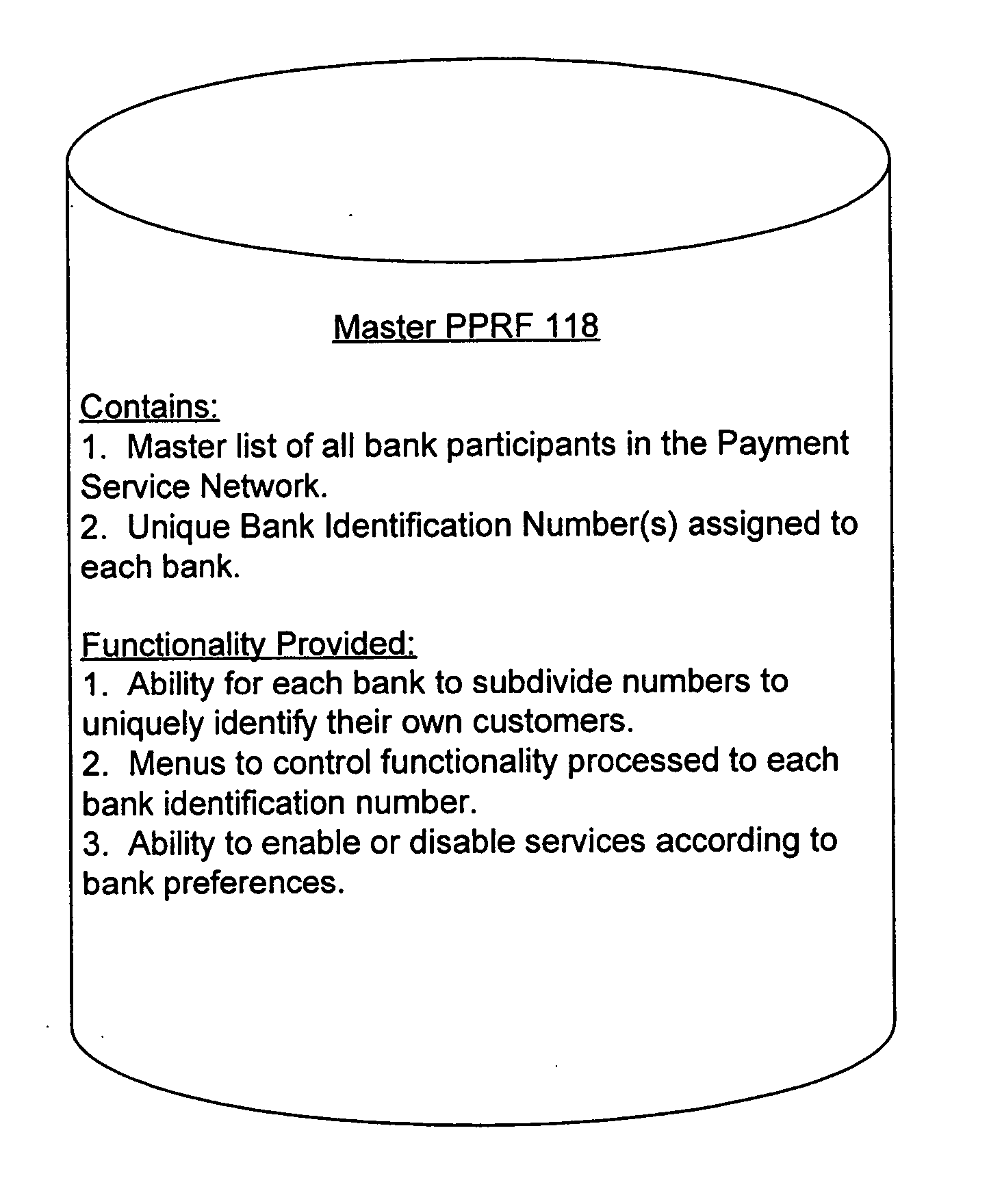

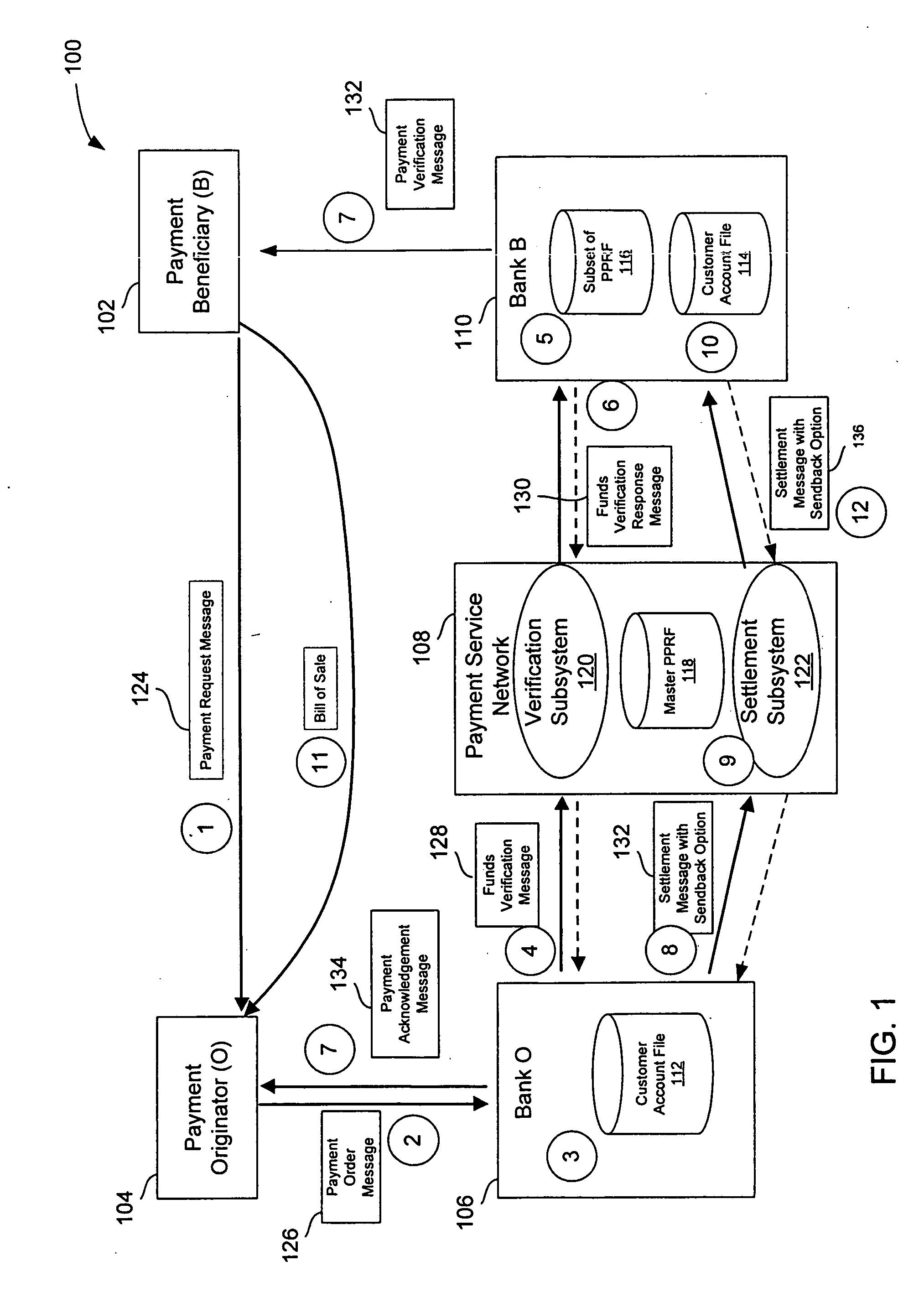

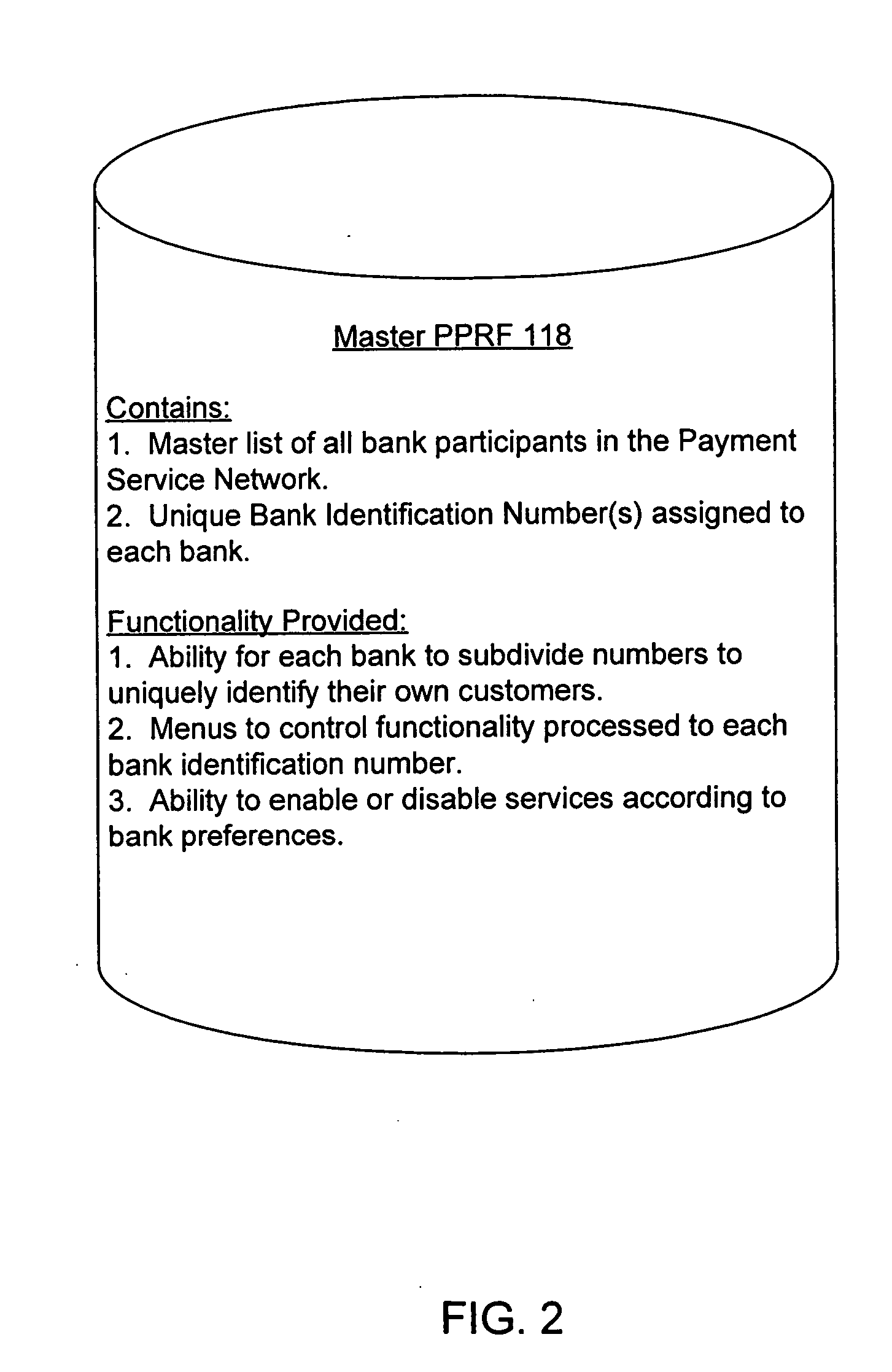

Transferring funds from a payment originator (or payor) to a payment beneficiary (or payee) pushes the funds directly to a beneficiary's bank. The beneficiary's bank is not required to actively pull funds into the beneficiary's account. An originator can use a publicly known beneficiary indicator to direct payment to the beneficiary. The publicly known beneficiary indicator can be publicly used without exposing a beneficiary account to unauthorized debits or fraud since it can only be used to make credits to the beneficiary account, e.g. a deposit-only account. A pre-settlement conversation is used between the two banks to verify and evaluate information about an upcoming transfer of funds to determine whether to accept the funds transfer. The messages in the pre-settlement conversation contain information about the transaction.

Owner:VISA INT SERVICE ASSOC

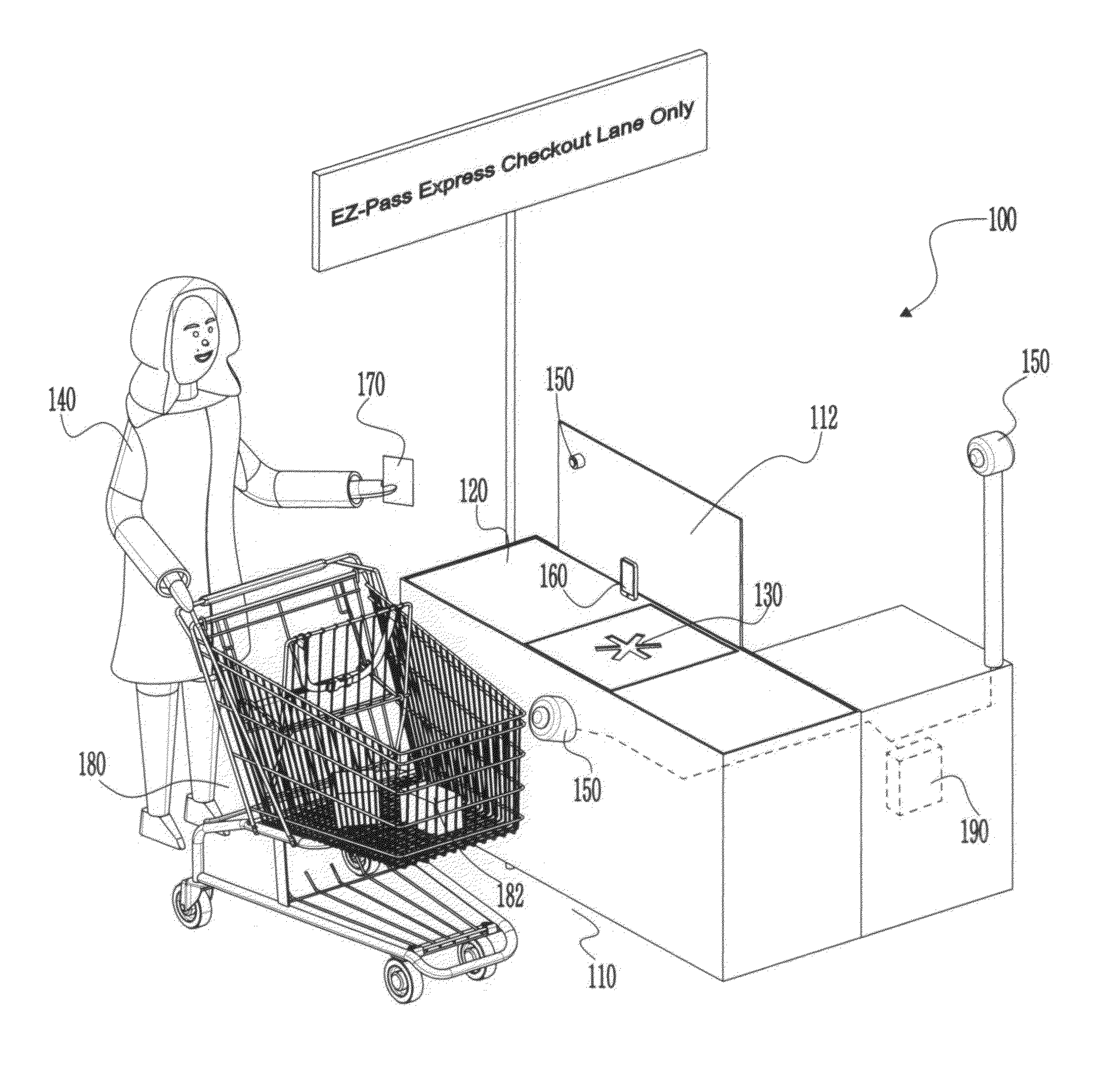

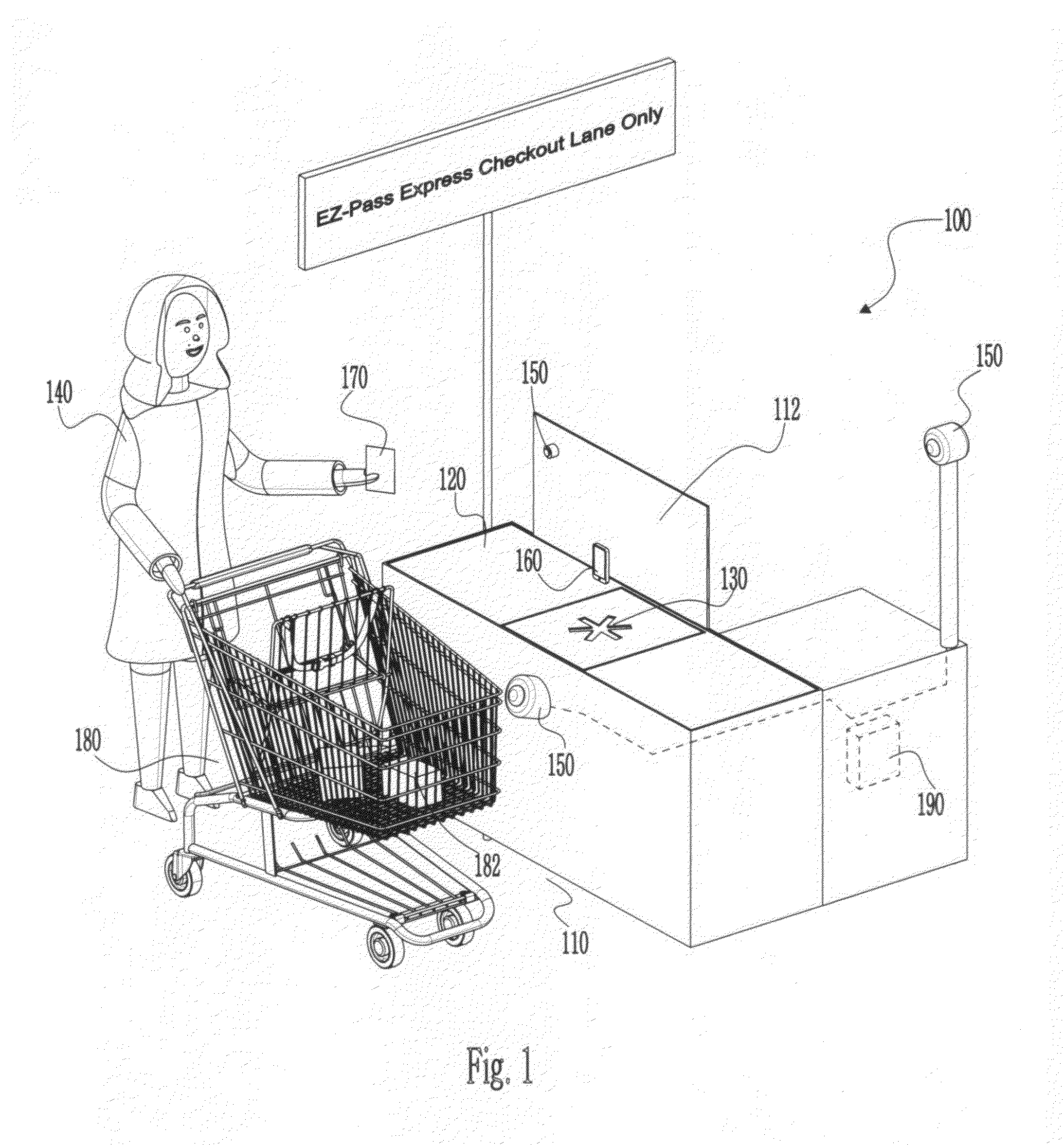

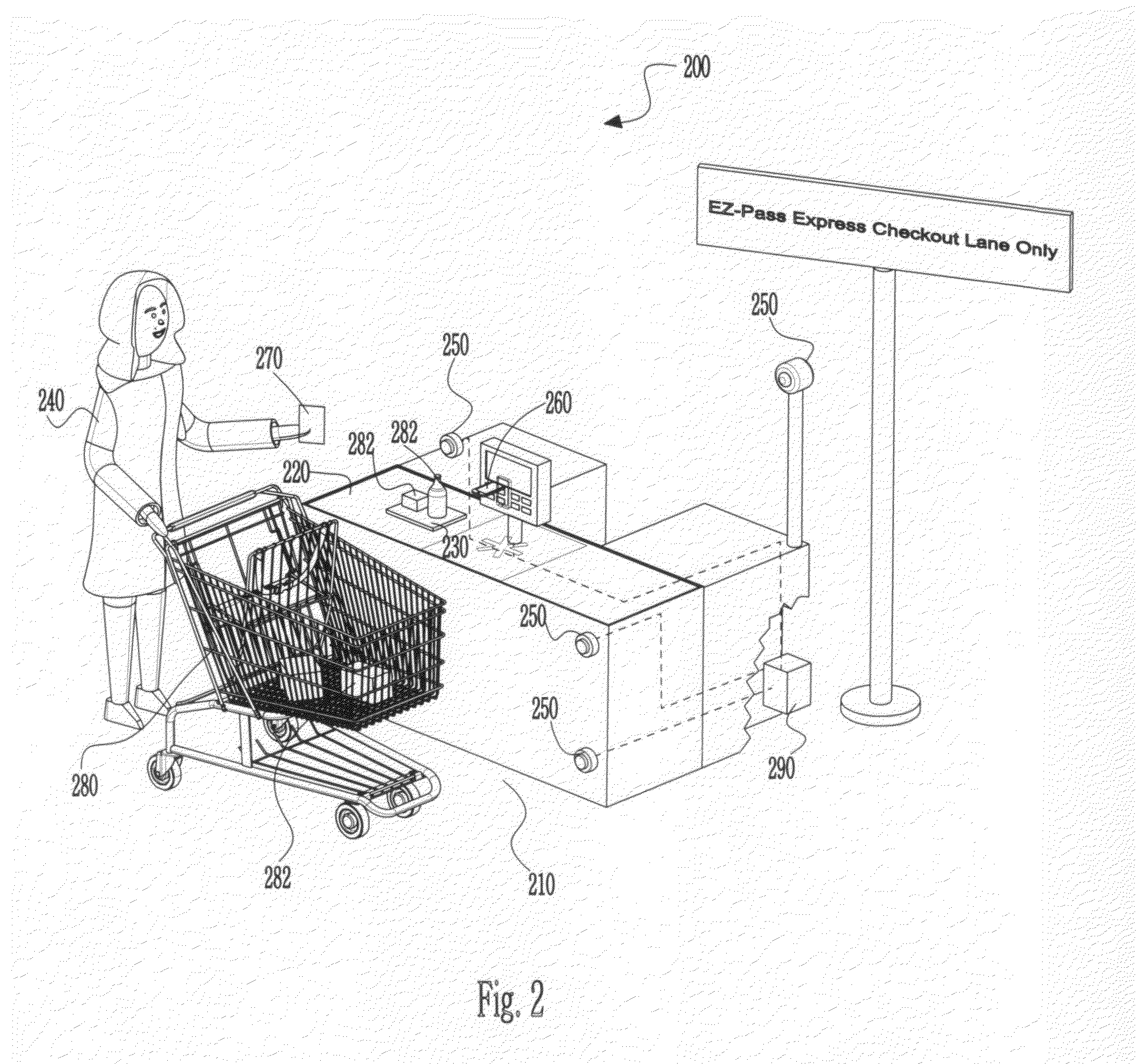

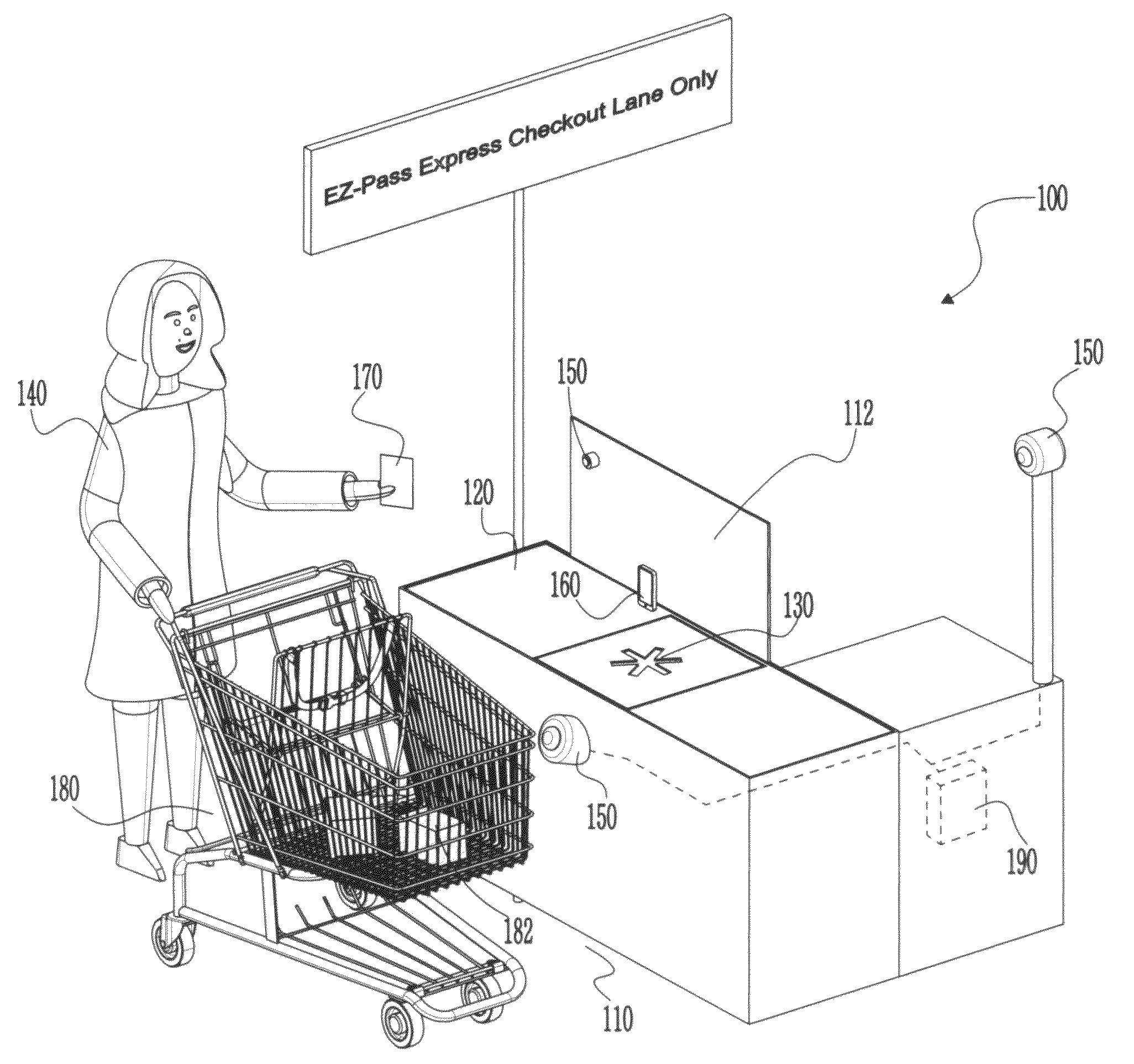

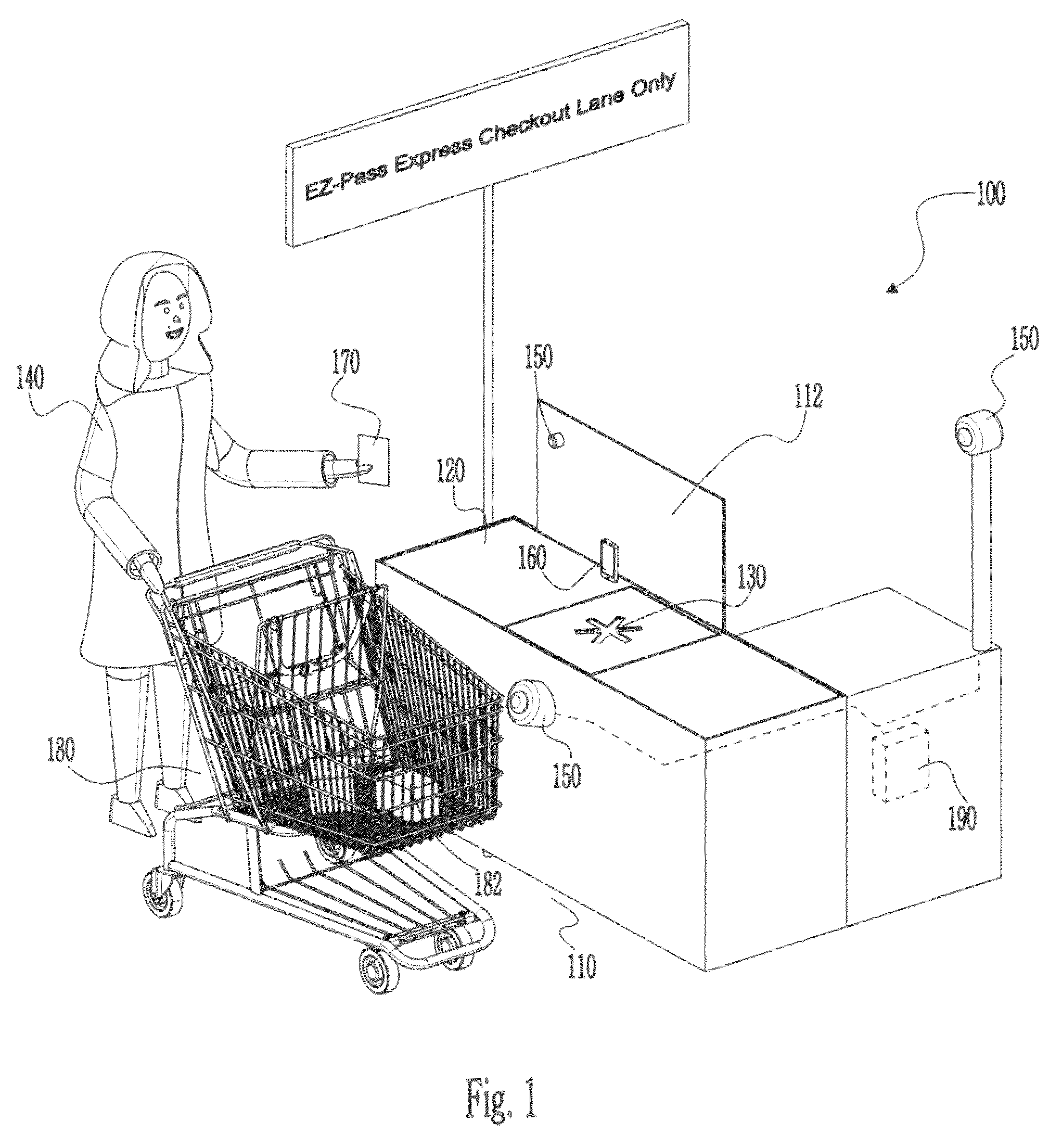

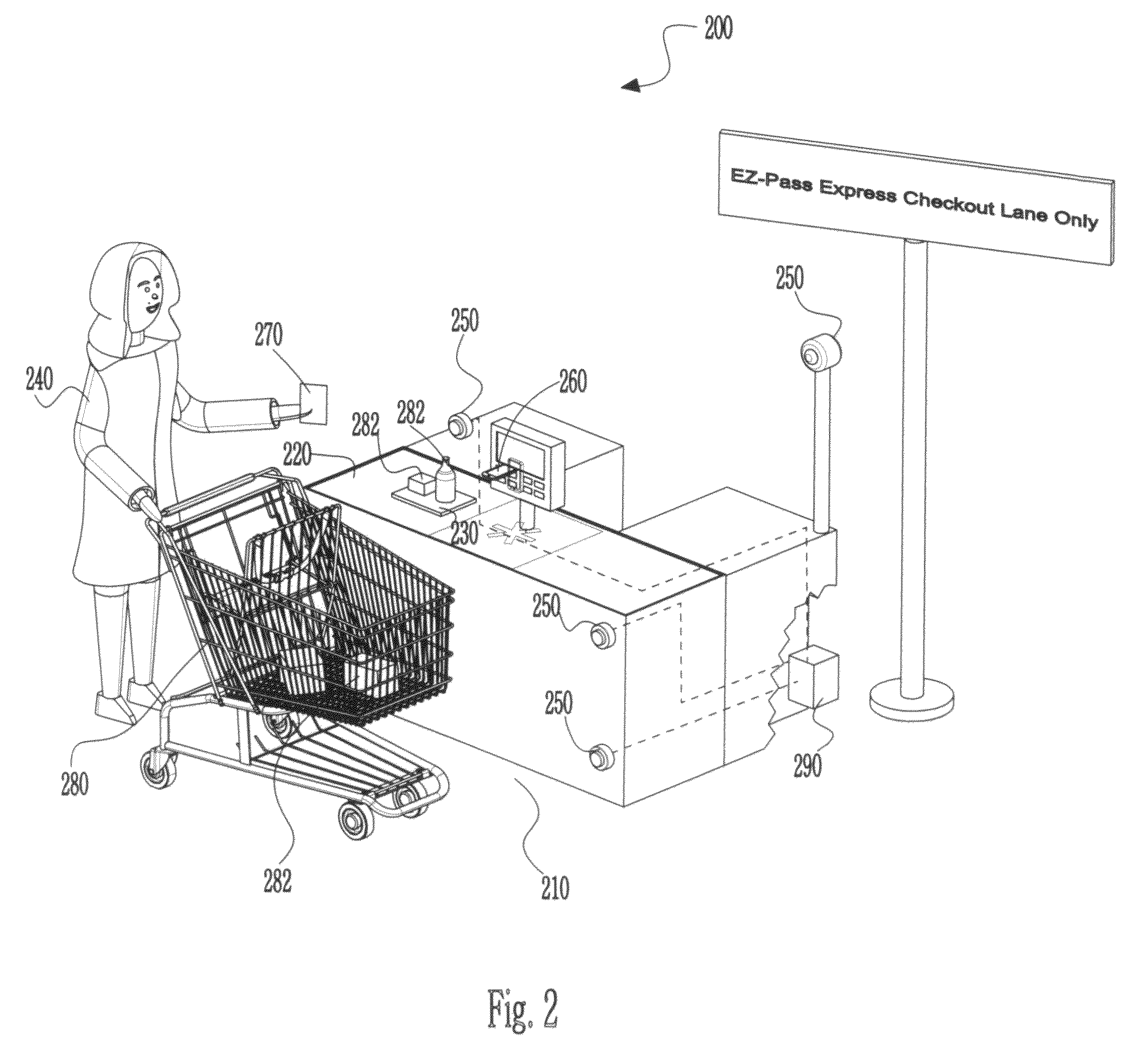

Express easy-pass checkout at grocery stores and retail establishments for preferred members

A grocery store or retail establishment easy-pass (E-Z) lane system for enabling express non-contact payment of a plurality of items is presented including an E-Z pass express checkout lane having at least a scanner for scanning the plurality of items and provided exclusively to preferred members pre-registered with the grocery store or retail establishment. The system includes an RFID antenna positioned about the E-Z pass express checkout lane for communicating with an RFID transponder issued to a preferred member when the RFID transponder is in close proximity to the RFID antenna. The E-Z pass checkout lane is activated thereafter for use by the preferred member for express checkout without the preferred member furnishing direct payment at the E-Z pass express checkout lane via a personal payment account that is separate and distinct from a prepaid vendor-established and maintained purchasing account.

Owner:KOUNTOTSIS THEODOSIOS +1

Direct payment with token

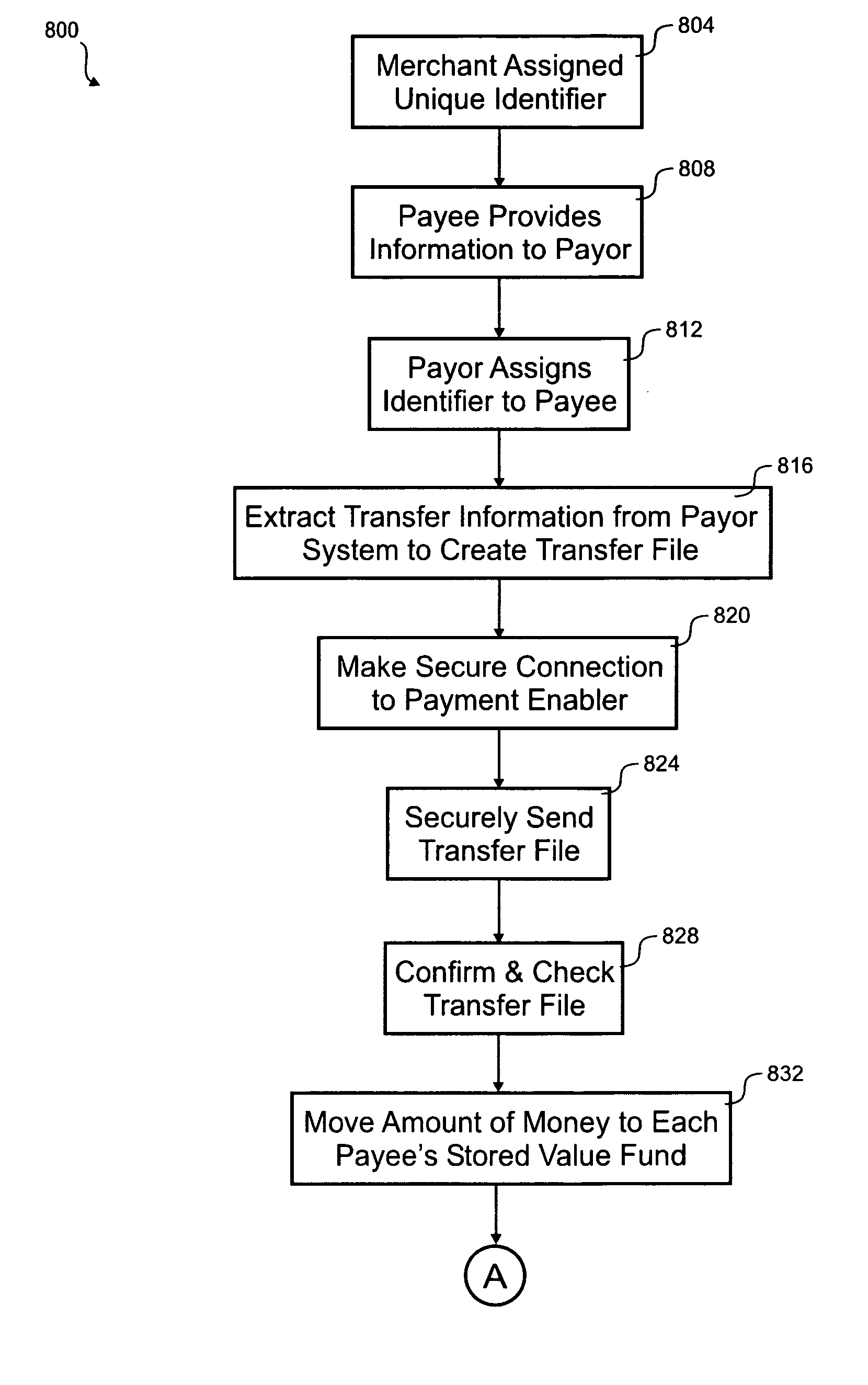

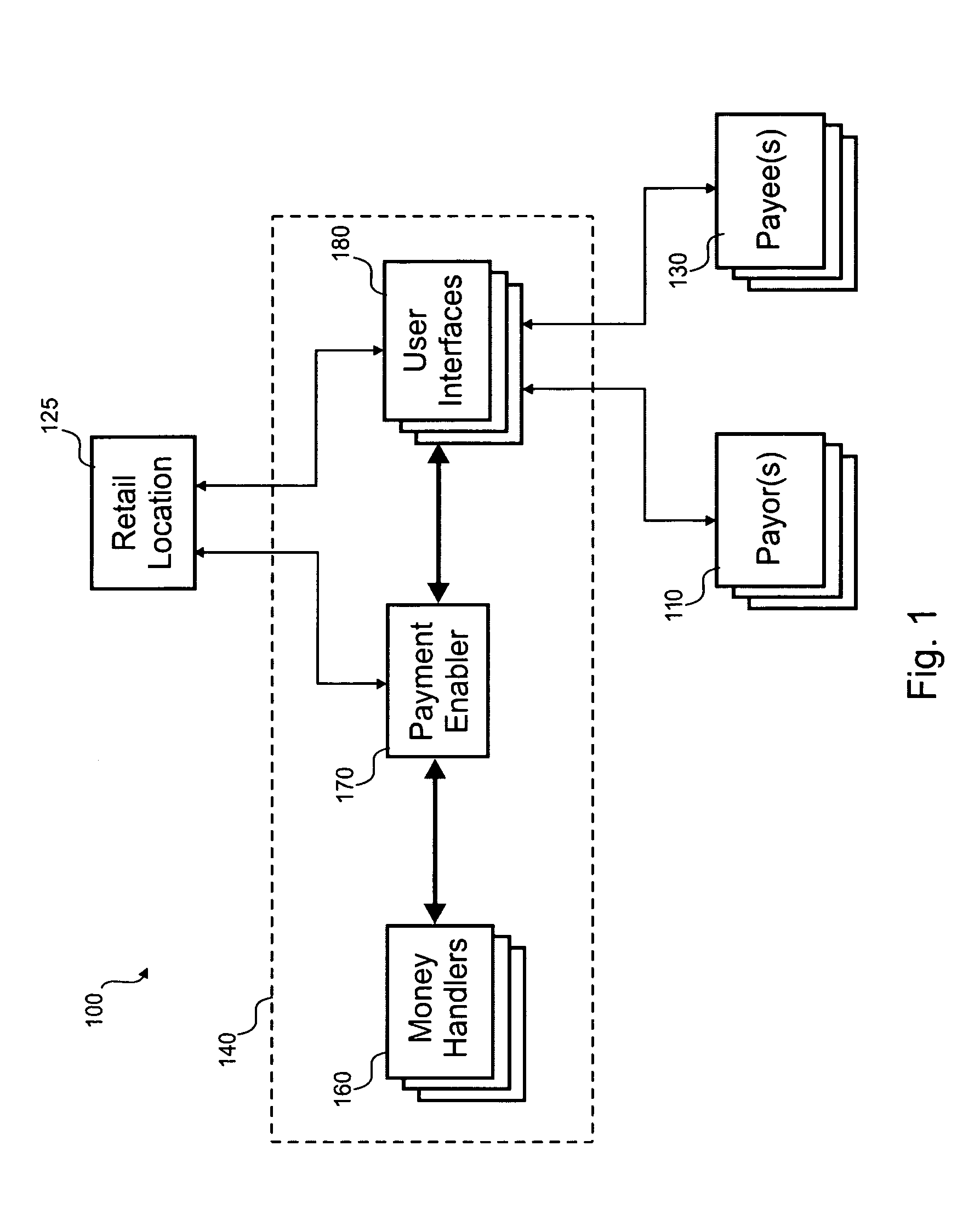

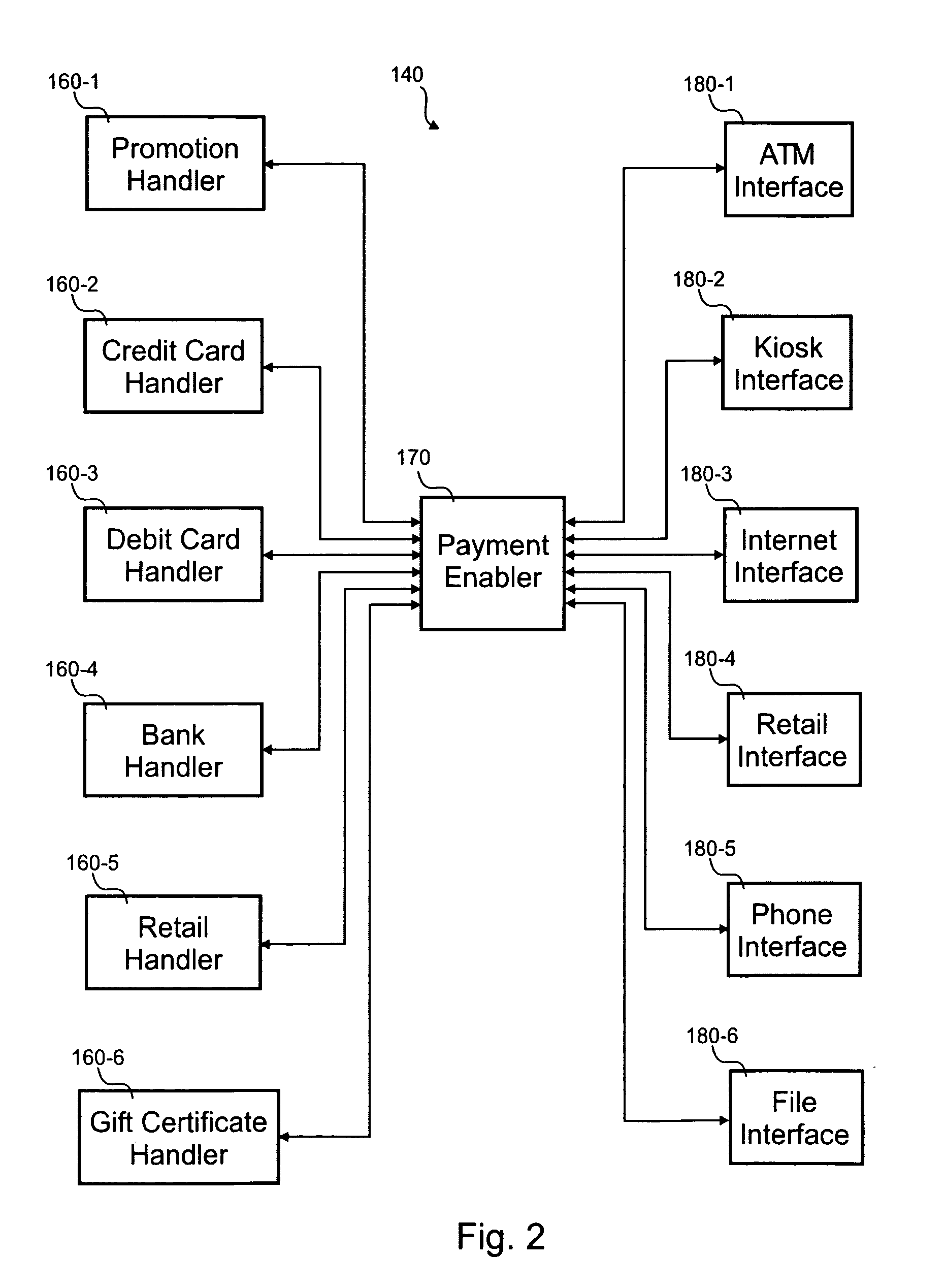

According to the invention, a method for transferring funds from a sender to one or more recipients using a wide-area computer network is disclosed. In one step, transfer information is received from the sender with the wide area computer network to transfer credit to from the sender to a recipient. The transfer information includes at least an identifier and a credit amount. The identifier is generated by the sender. The identifier is unique to the recipient. It is determined if the transfer information is complete. A message is sent to the recipient. Transfer of a transfer amount related to the credit amount is paused based, at least in part, on the transfer information being incomplete. The transfer of the transfer amount is completed after the transfer information is complete.

Owner:THE WESTERN UNION CO +1

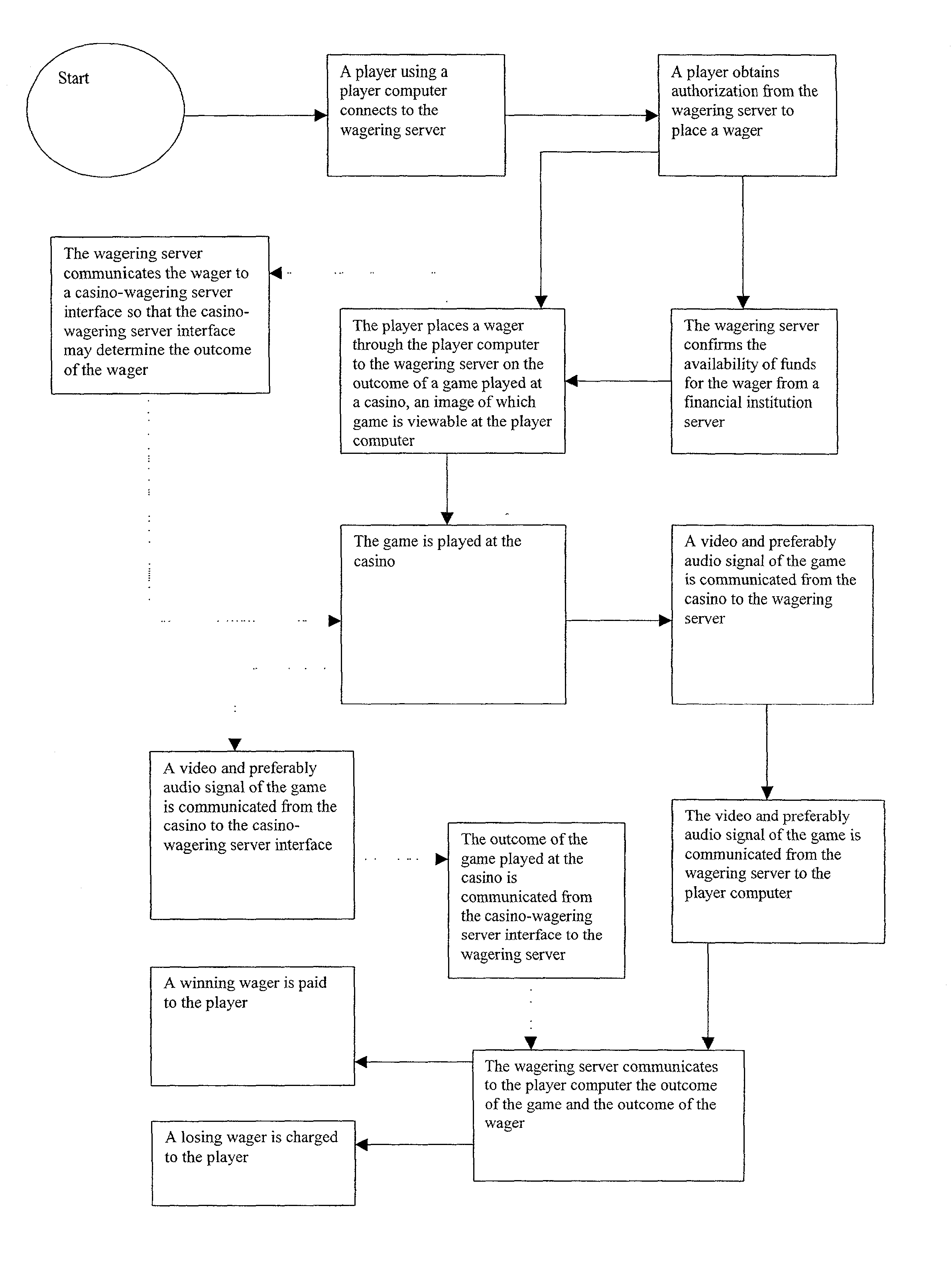

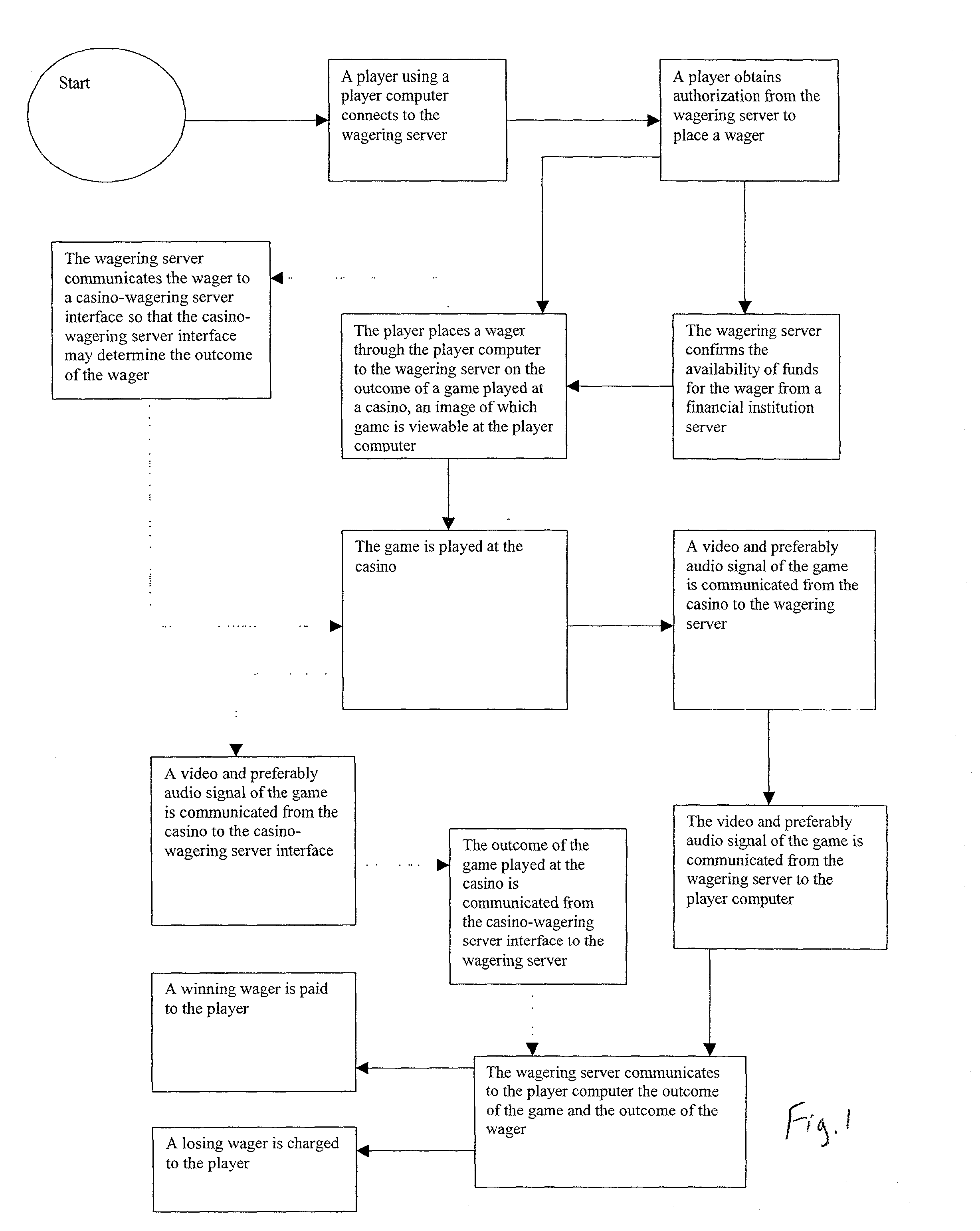

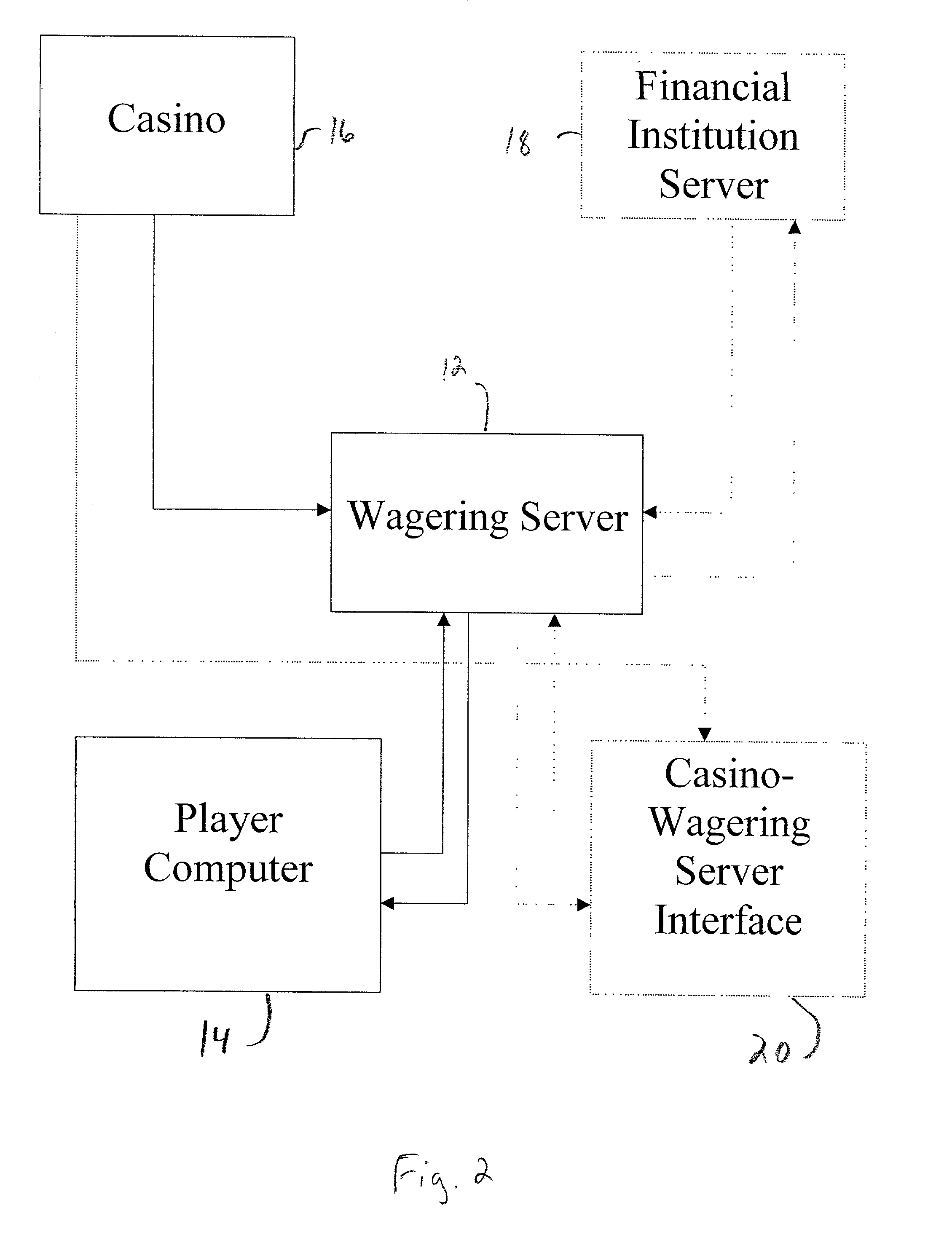

Networked casino gaming system and method of participation

InactiveUS20020103028A1Apparatus for meter-controlled dispensingVideo gamesCredit cardDirect Payments

A networked gaming system and method permitting a person using a player computer to view a game being played live at a casino, and to wager on the outcome of the game. The player computer is in communication with a wager server, which in turn is receiving at least a video and preferably also an audio signal of the casino game from the casino. Wagering may be accomplished by a variety of payment methods, including direct payment from a player computer to the wagering server or through the use of a credit-type card, in which instance a financial institution server will also be part of the system and method. Preferably, an additional system component is provided, consisting of a casino-wagering server interface, which will be in communication with the casino and wagering server, will monitor the game being played and the wager, and which will determine the outcome of the wager and communicate that information to the wagering server for communication to the player computer.

Owner:ATMAN GRP LLC THE

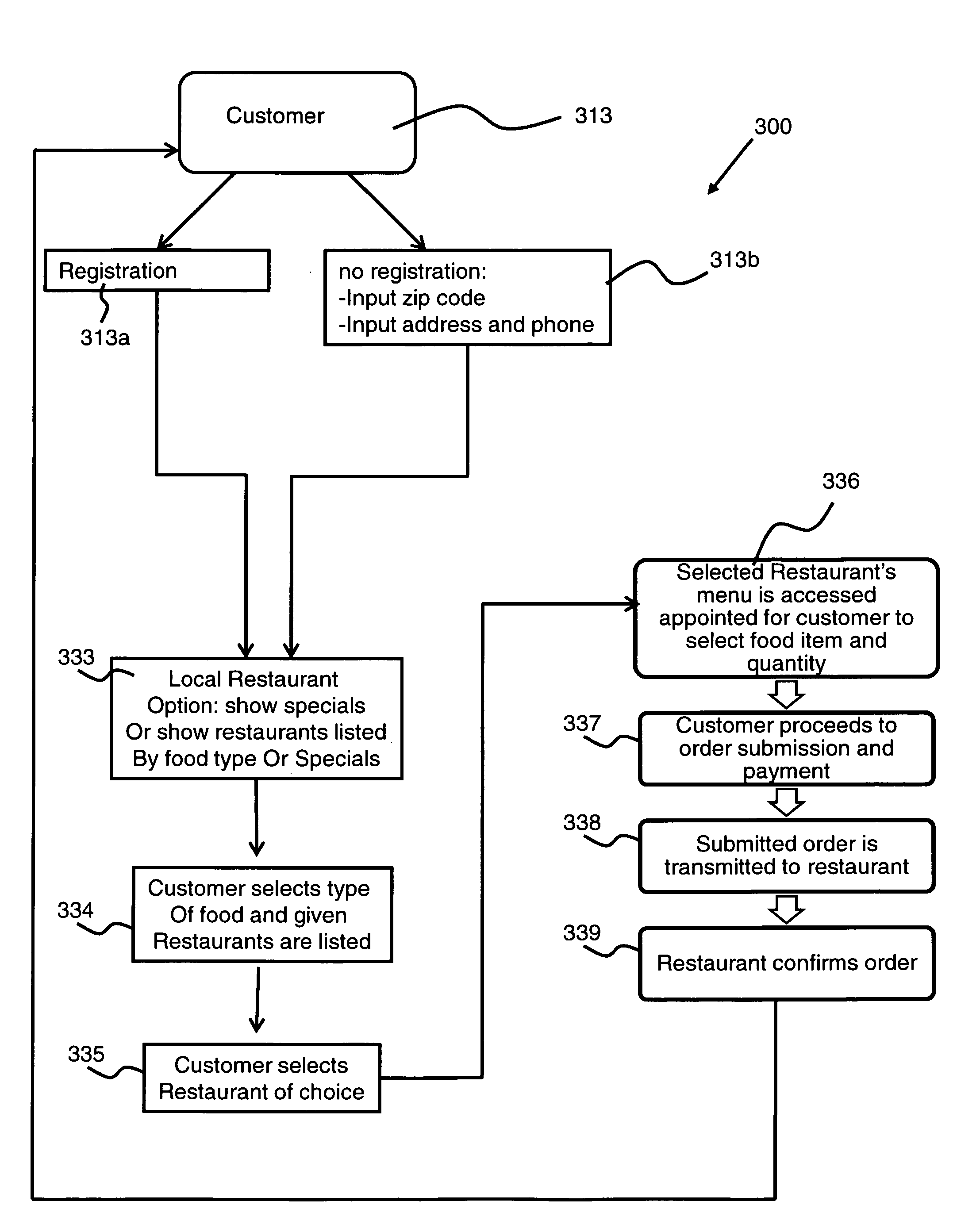

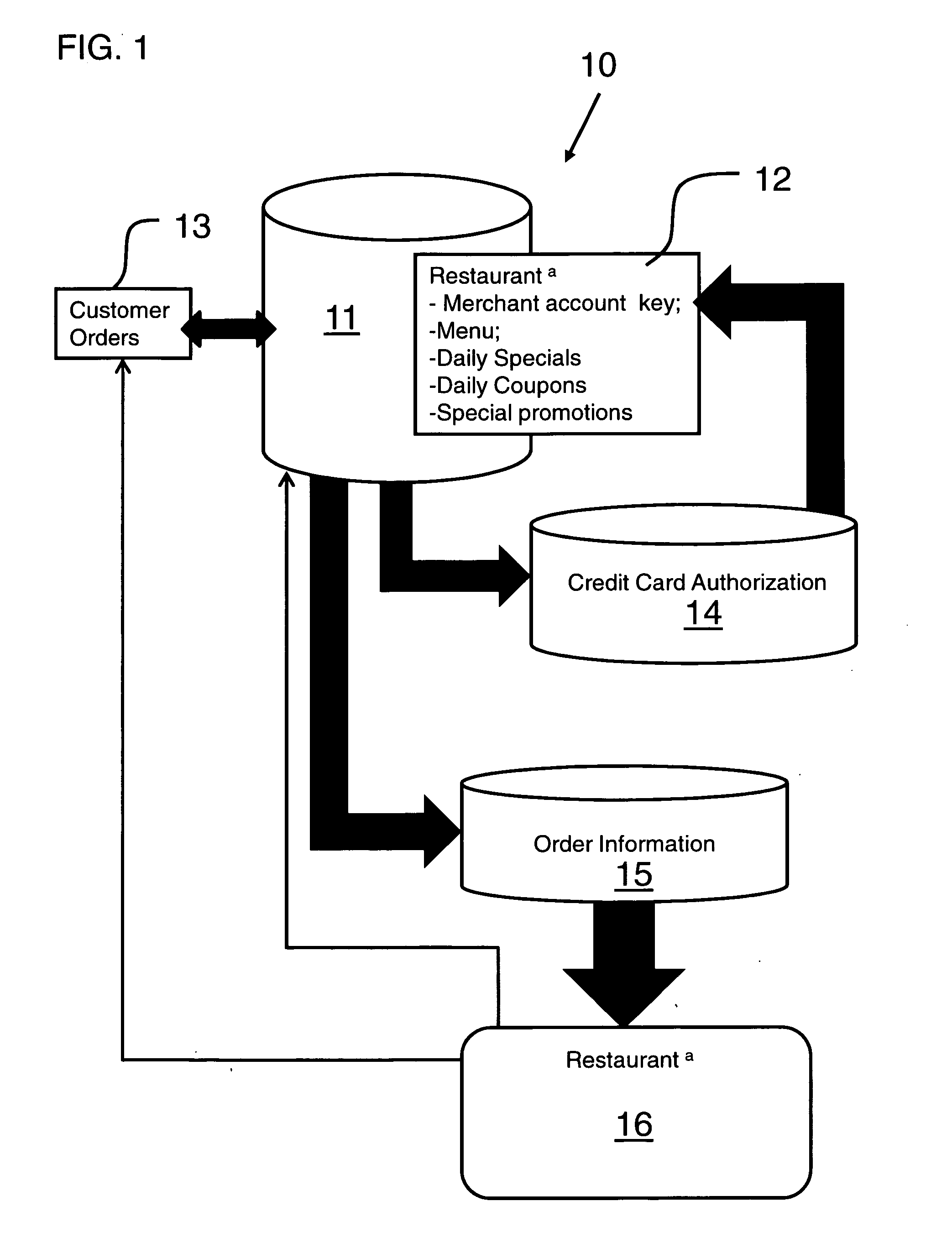

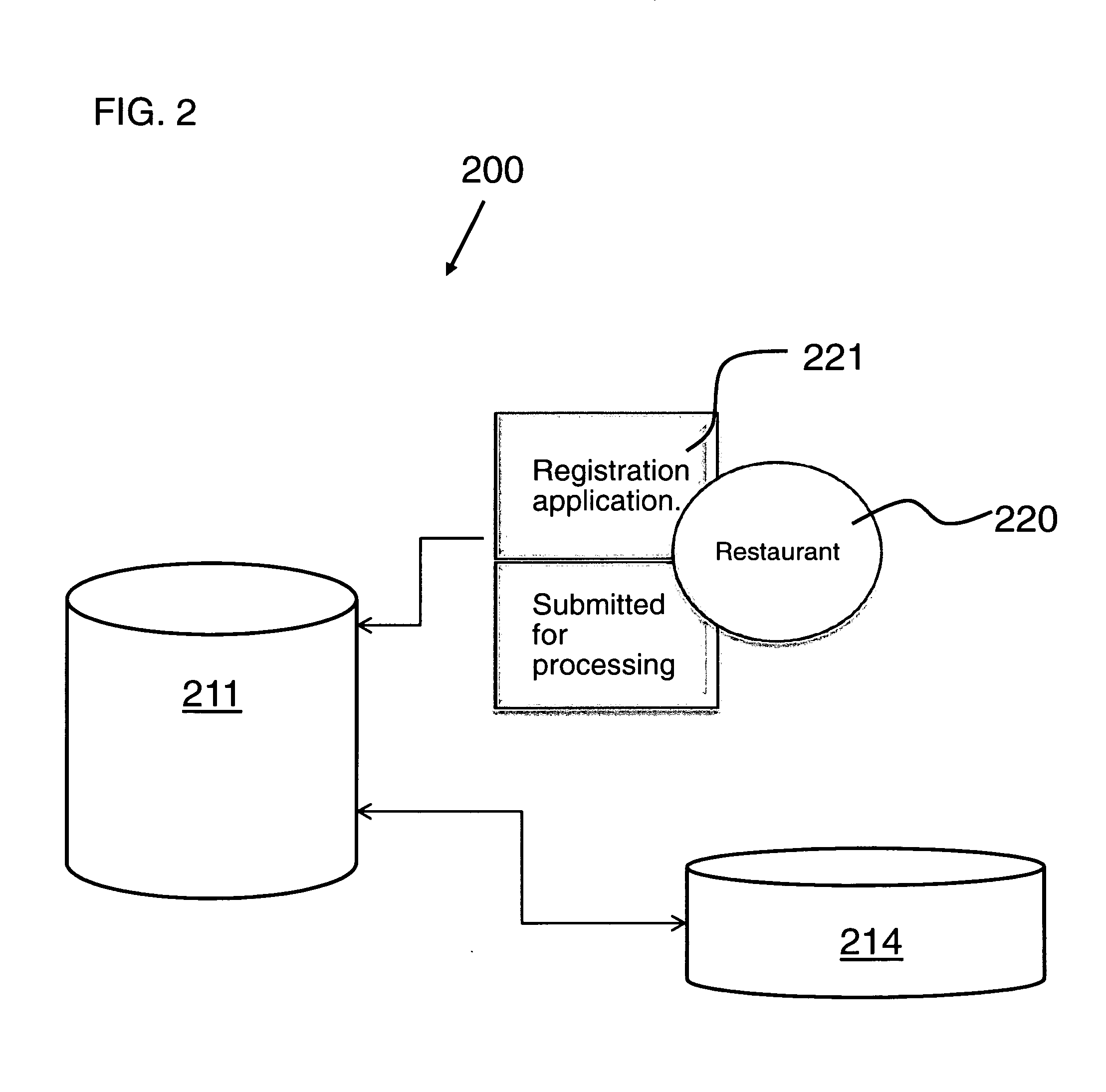

Online food ordering system and method

Restaurants register for an online food ordering system and method to have their menus presented on the online system. Registration is accomplished by payment of a fixed registration fee. A merchant account is created for each restaurant. The merchant account is associated with a unique account key that includes a local delivery indicator and direct payment receivable account information facilitating direct payment to the restaurant's account. A first server is appointed for receiving orders from customers. The first server includes a data storage device having menu items and information from each of the restaurants and each of the unique account keys associated with each restaurant. In communication with the first server are second and third servers for processing payments and transmitting orders to the restaurant for processing and fulfillment. An order confirmation means is further provided for notifying the customer upon submission of the order to the restaurant along with estimated pick-up or delivery times.

Owner:SCIFO DANILO +4

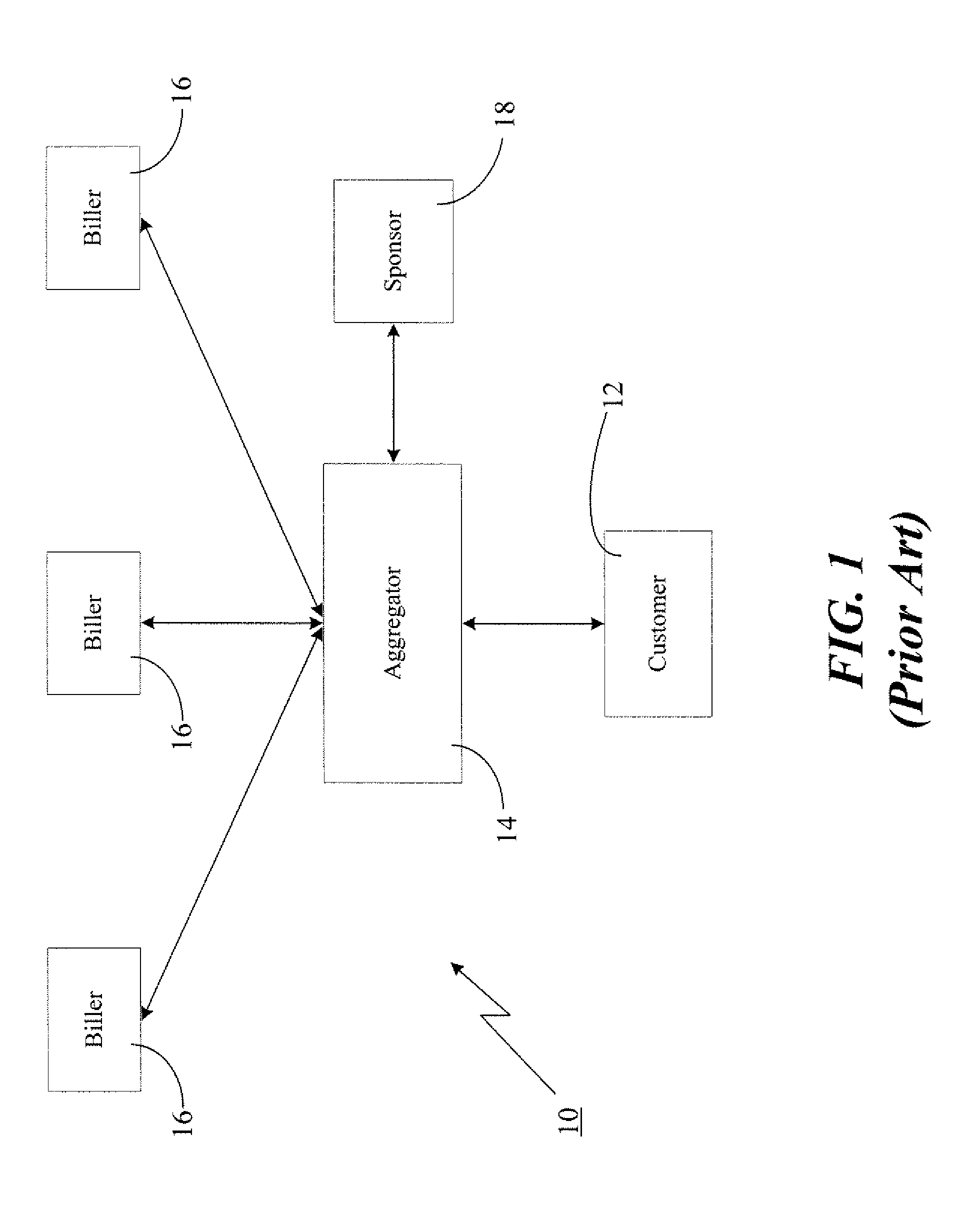

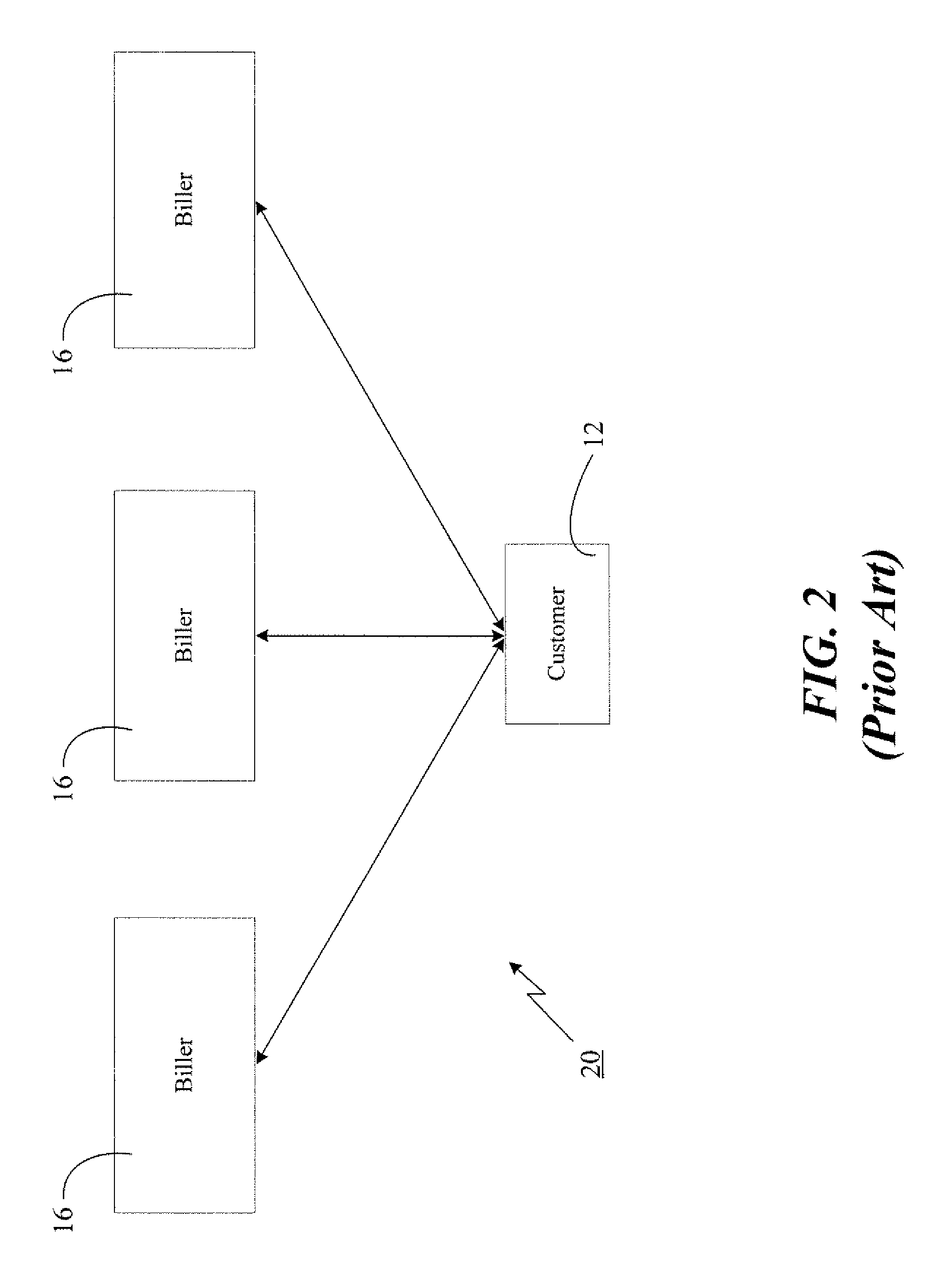

Dynamic biller list generation

A method, system and article of manufacture for processing bill payment information. Information identifying a payee is processed. The information is information identifying a payee to whom a payer intends to electronically direct payment. The processing determines if bills of the payee are available electronically. If the bills of the payee are available electronically, a notice is transmitted to the payer informing the payer that the bills from the payee are available electronically.

Owner:CHECKFREE SERVICES CORP +1

Online payment system and method

ActiveUS8725635B2User-friendly interfaceEasy to monitorFinanceProtocol authorisationThird partyInternet privacy

Owner:BANK OF AMERICA CORP

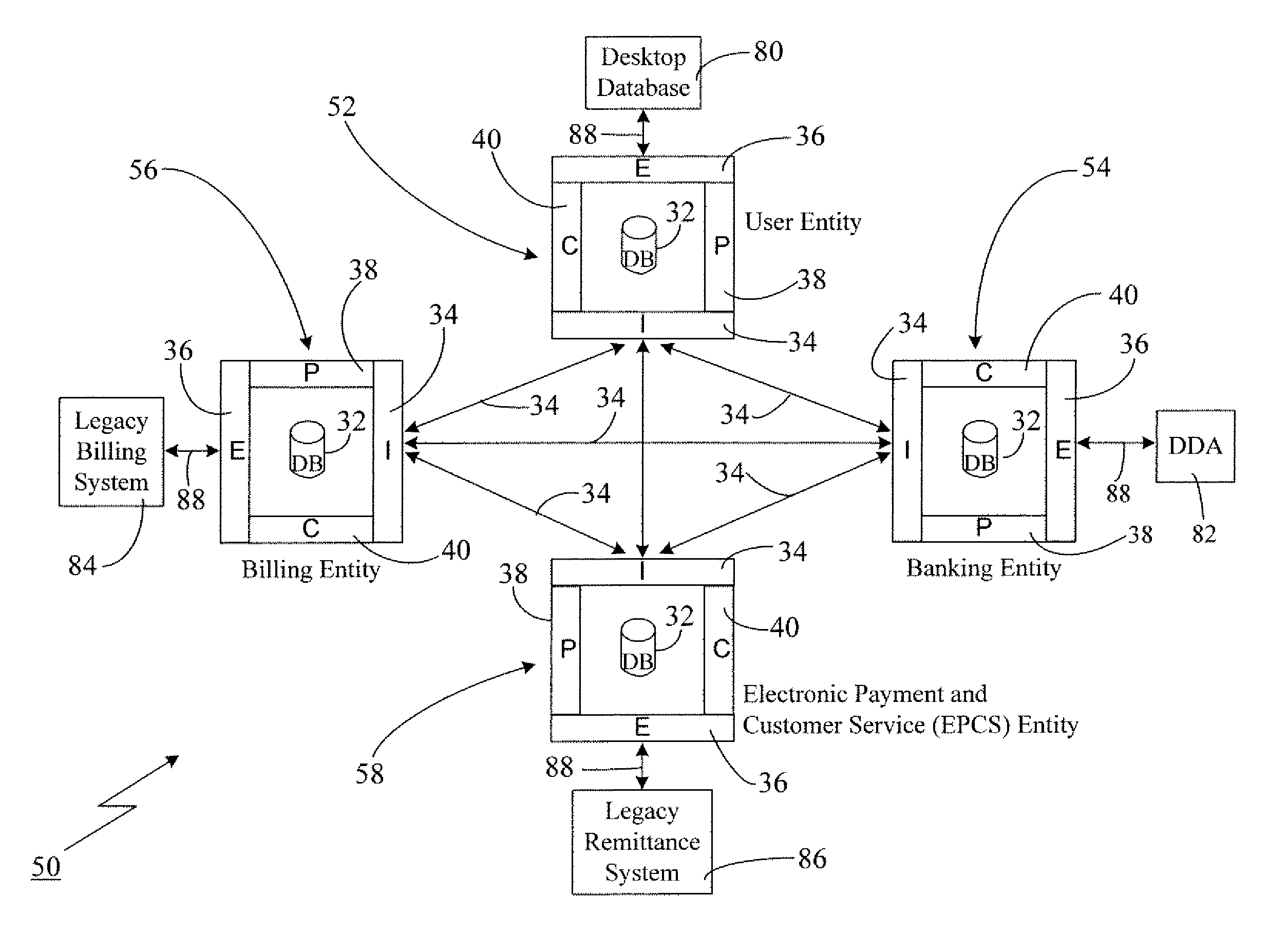

Electronic billing with updateable electronic bill summary

InactiveUS7392223B1Easily implemented using computer softwareEasy programmingComplete banking machinesFinanceTelecommunicationsMobile station

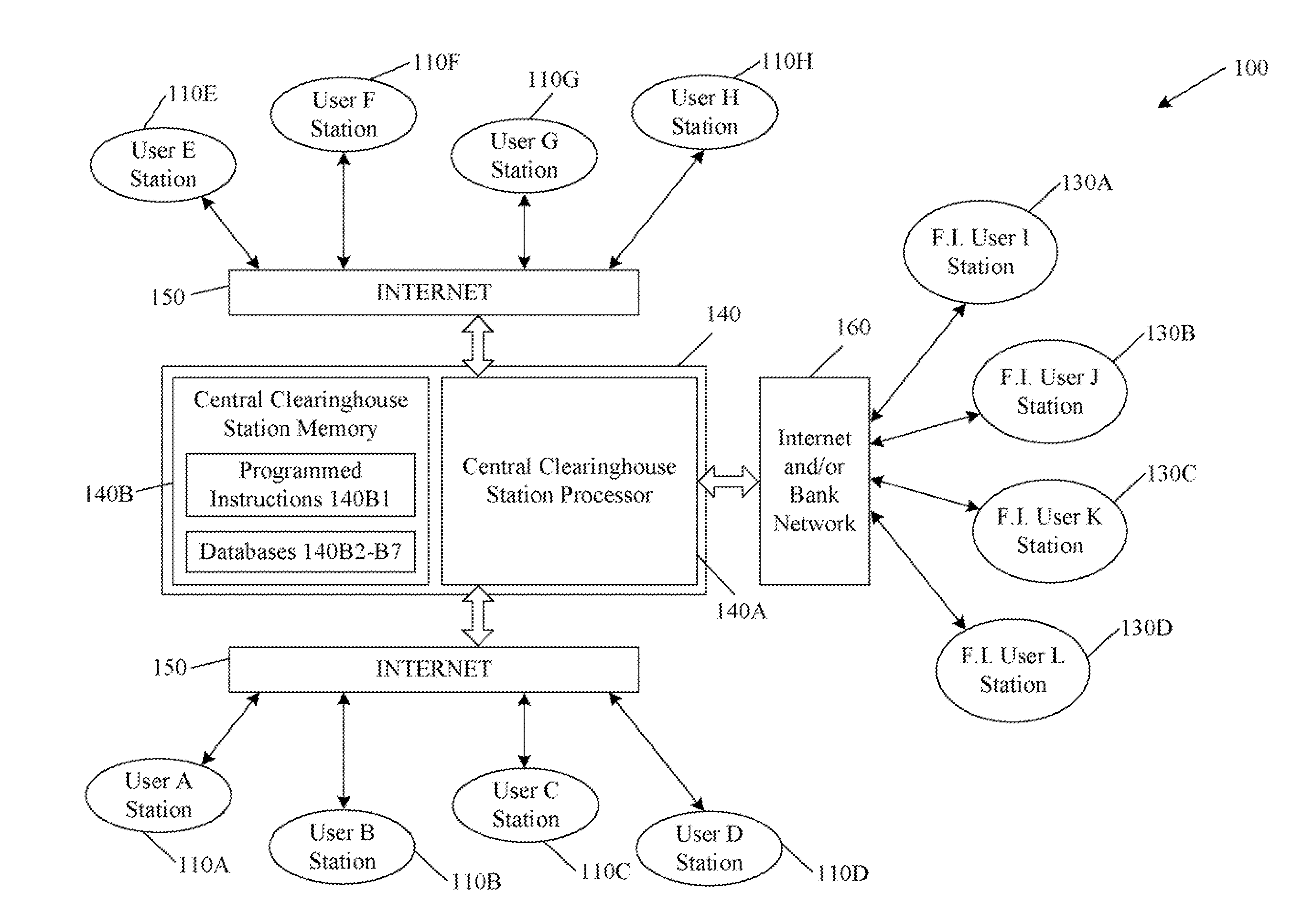

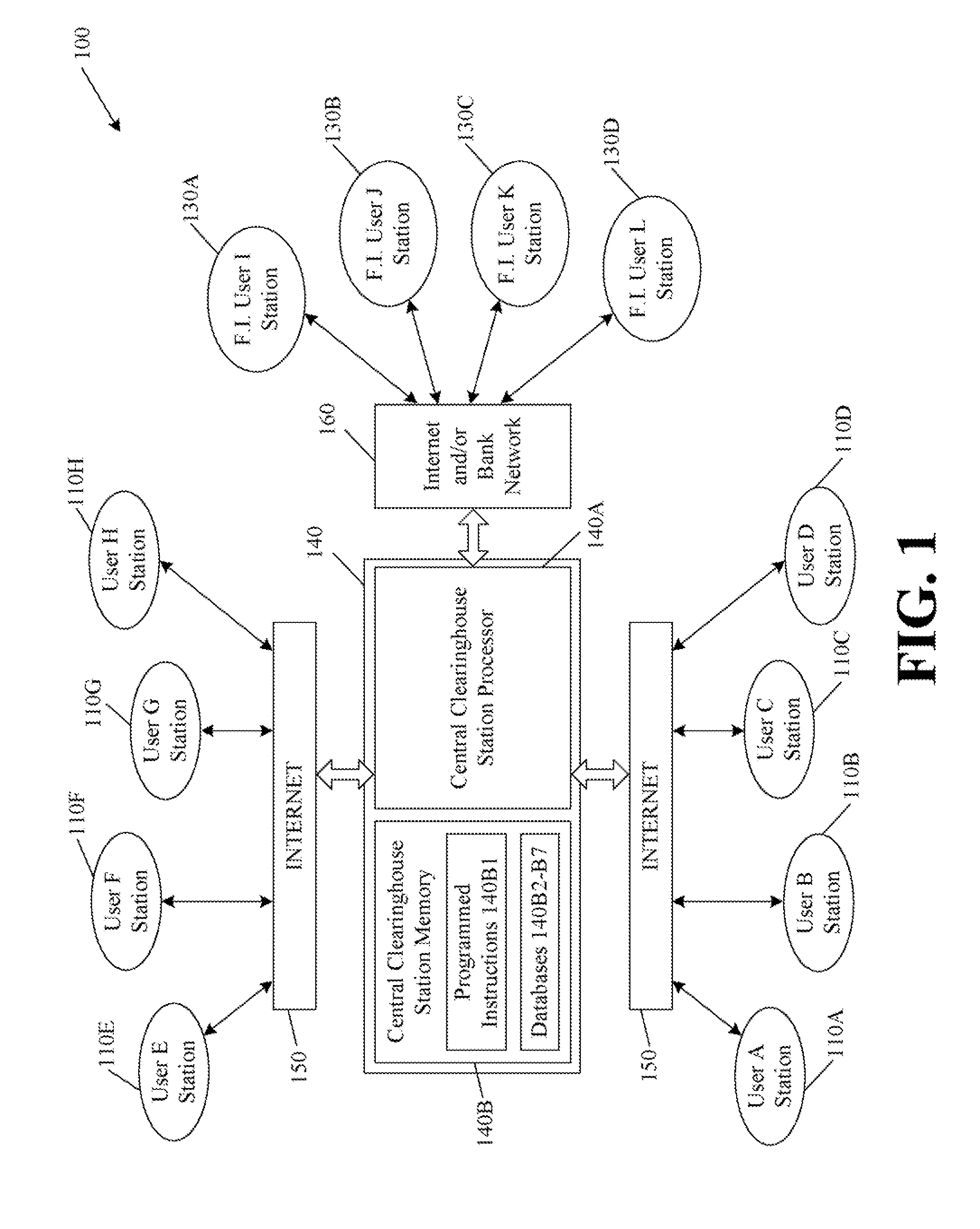

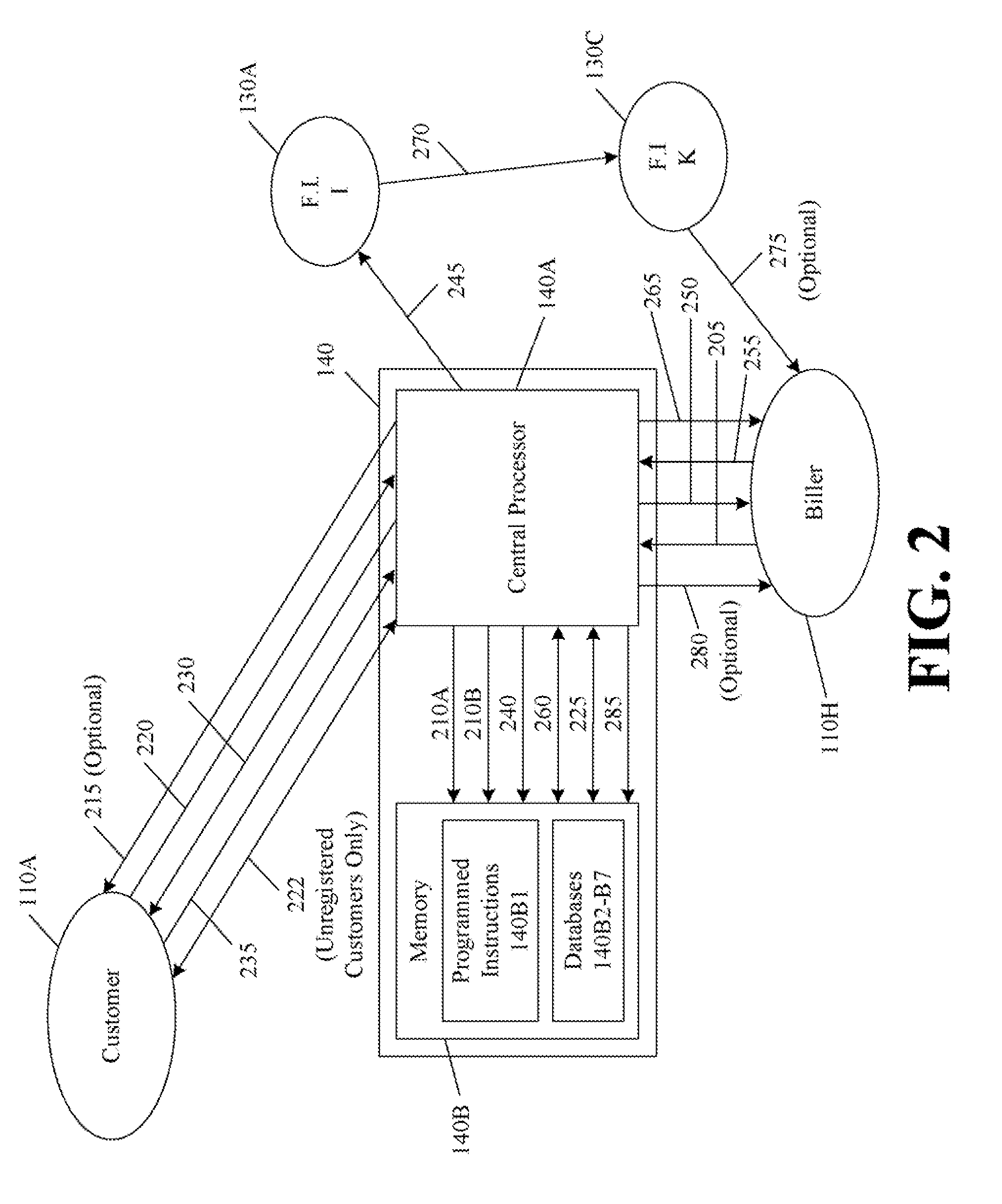

An electronic bill payment network includes a plurality of user network stations associated with different users, a plurality of biller network stations associated with different billers, and a central network station. A first user station operates, in real time, to transmit information relevant to an amount of an available bill and an instruction to pay the available bill. A first biller station operates, in real time, to receive the transmitted information and to compute the amount of the available bill based upon the received information. The central network station operates to receive the computed amount of the available bill and the transmitted pay instruction, and to direct payment of the computed amount of the available bill based upon the transmitted instruction to pay that bill.

Owner:CHECKFREE CORP

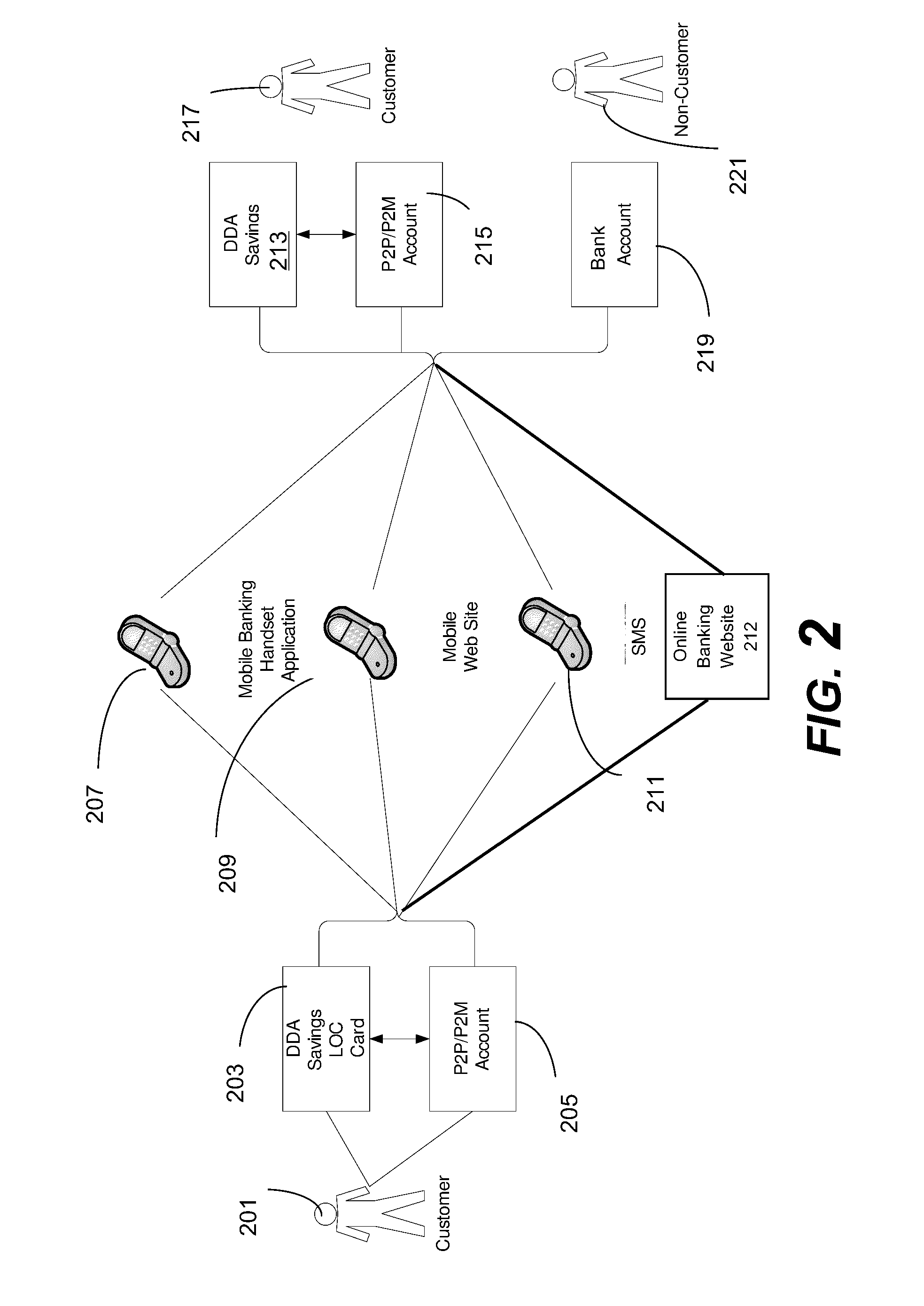

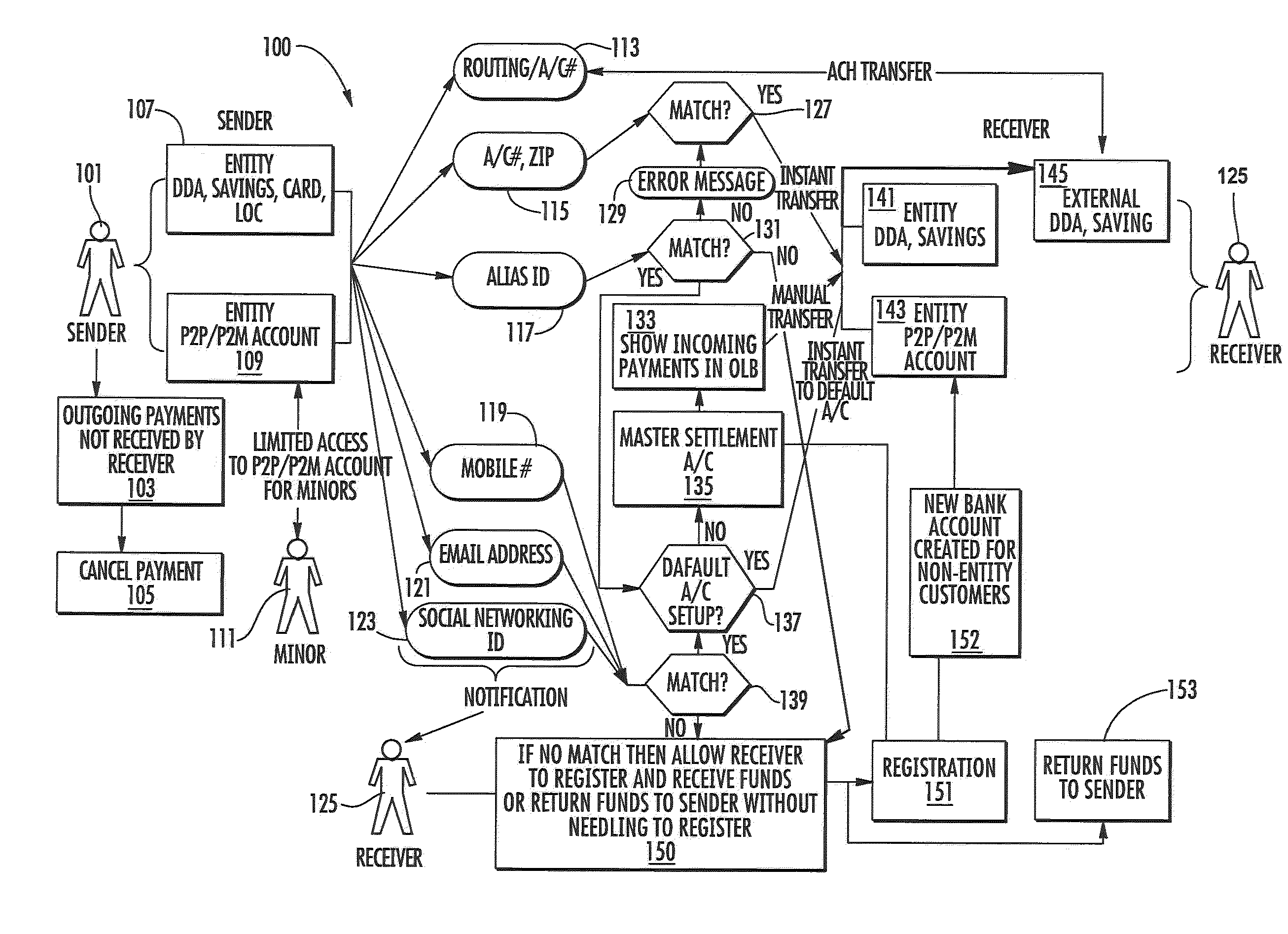

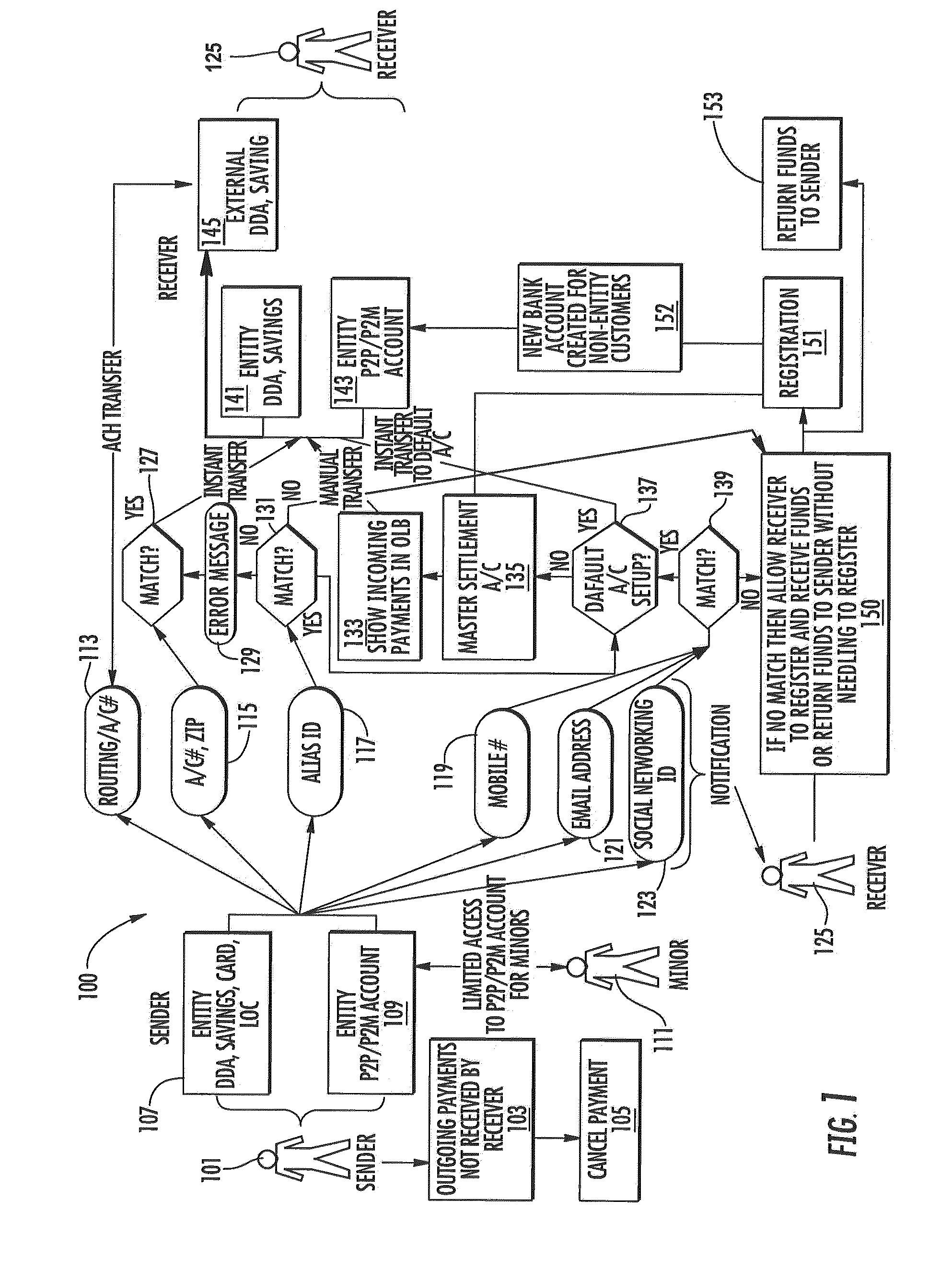

Mobile payment system and method

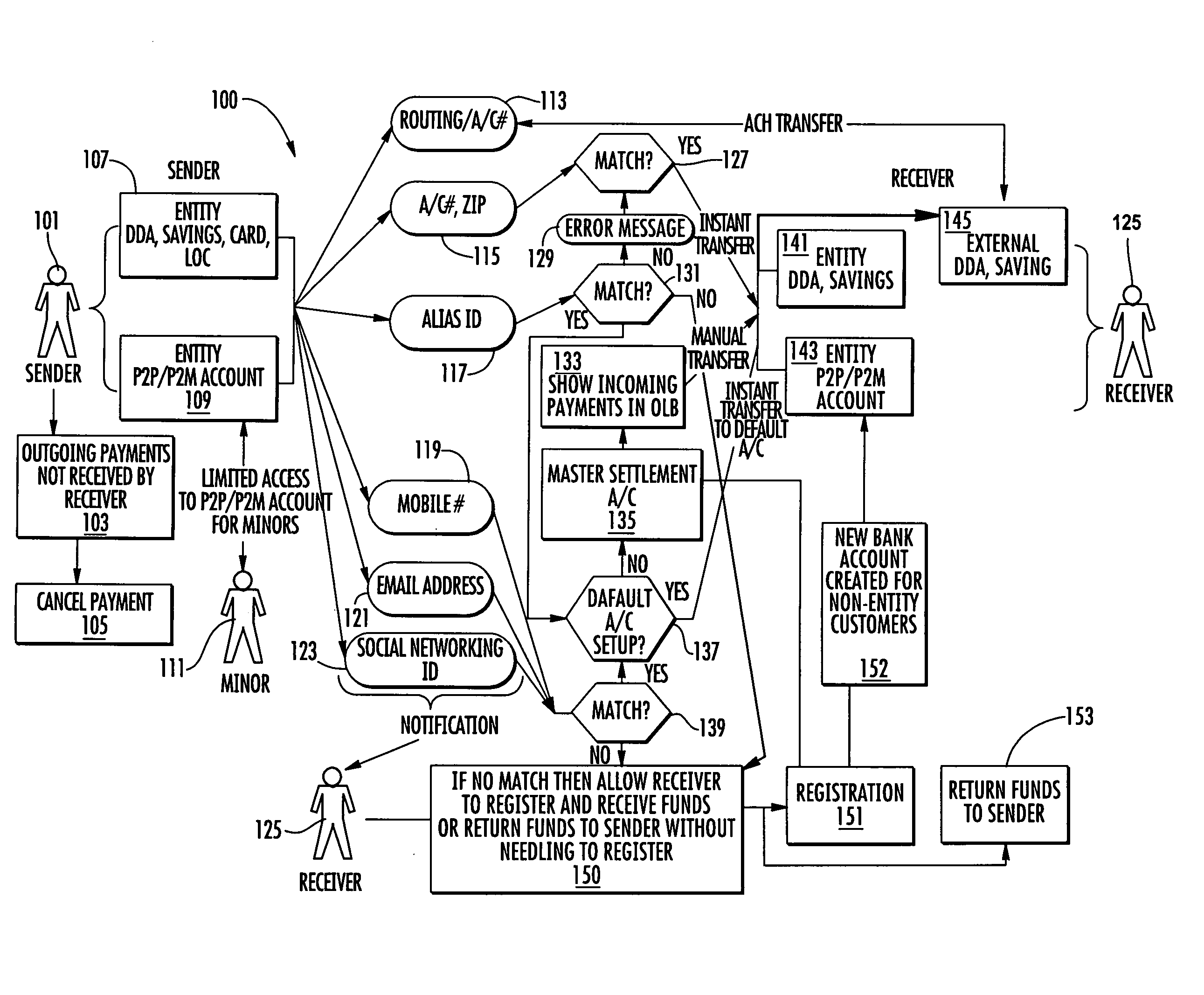

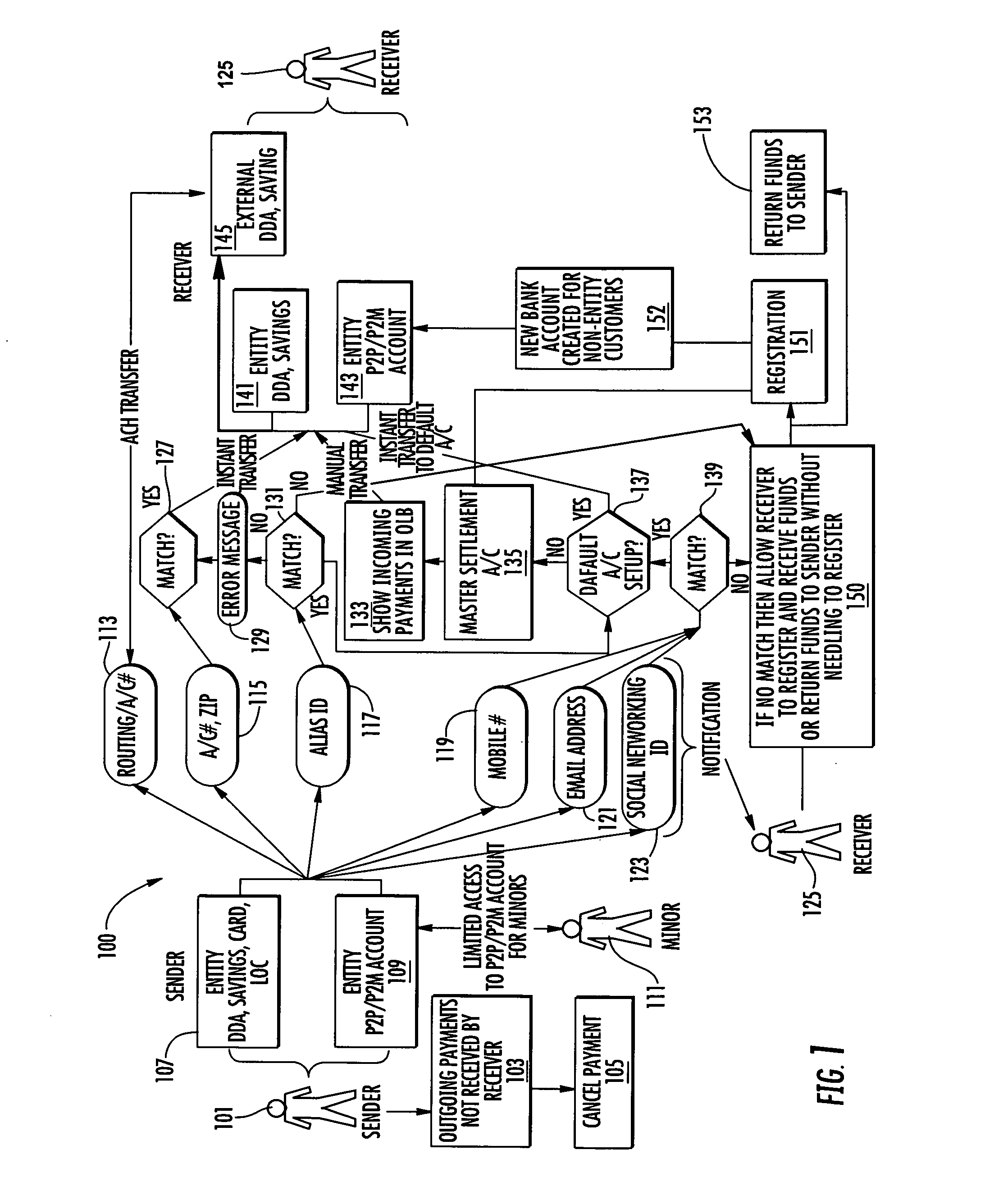

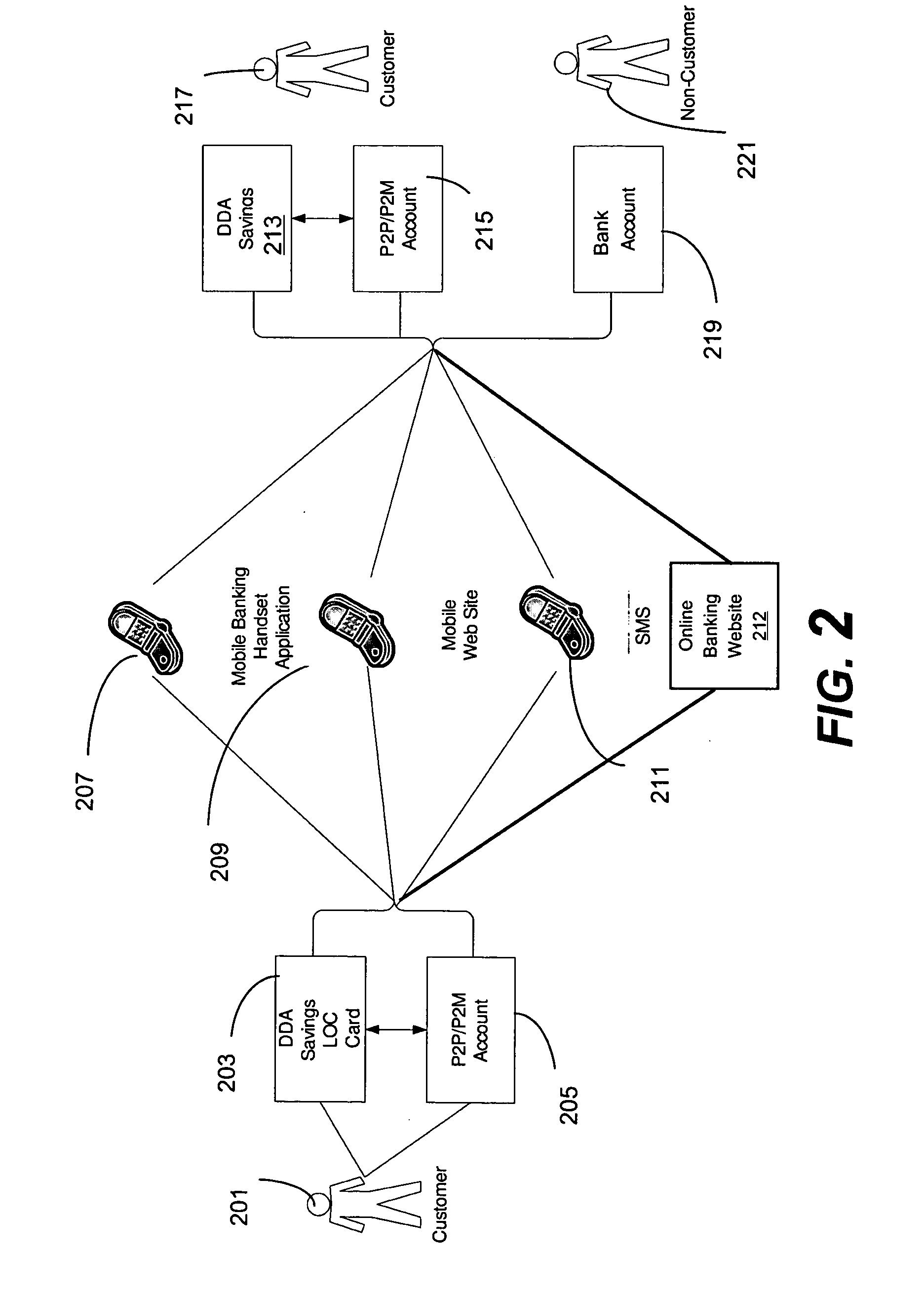

InactiveUS20120116967A1User-friendly interfaceConvenient registrationFinancePayment architectureThird partyUnique identifier

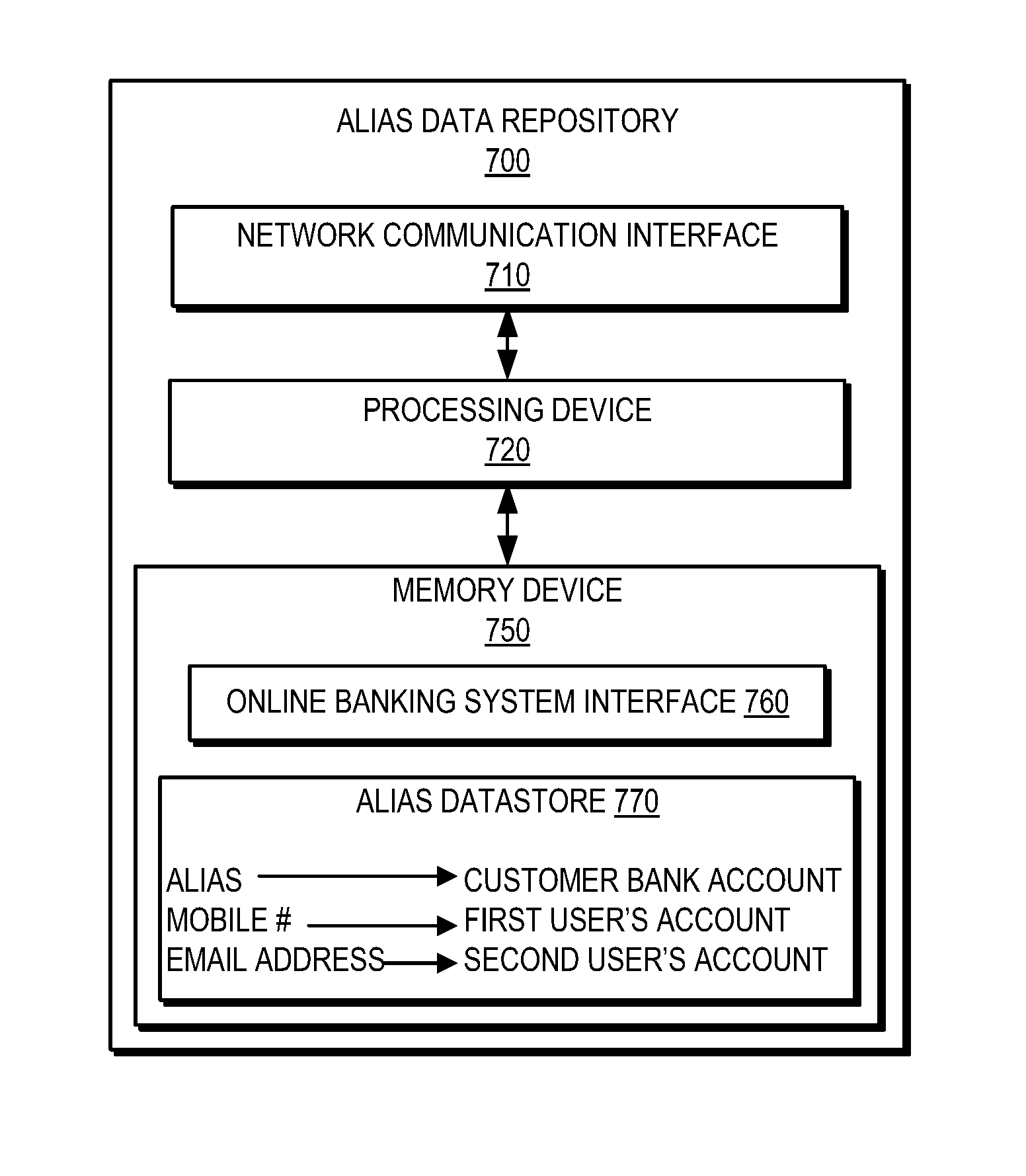

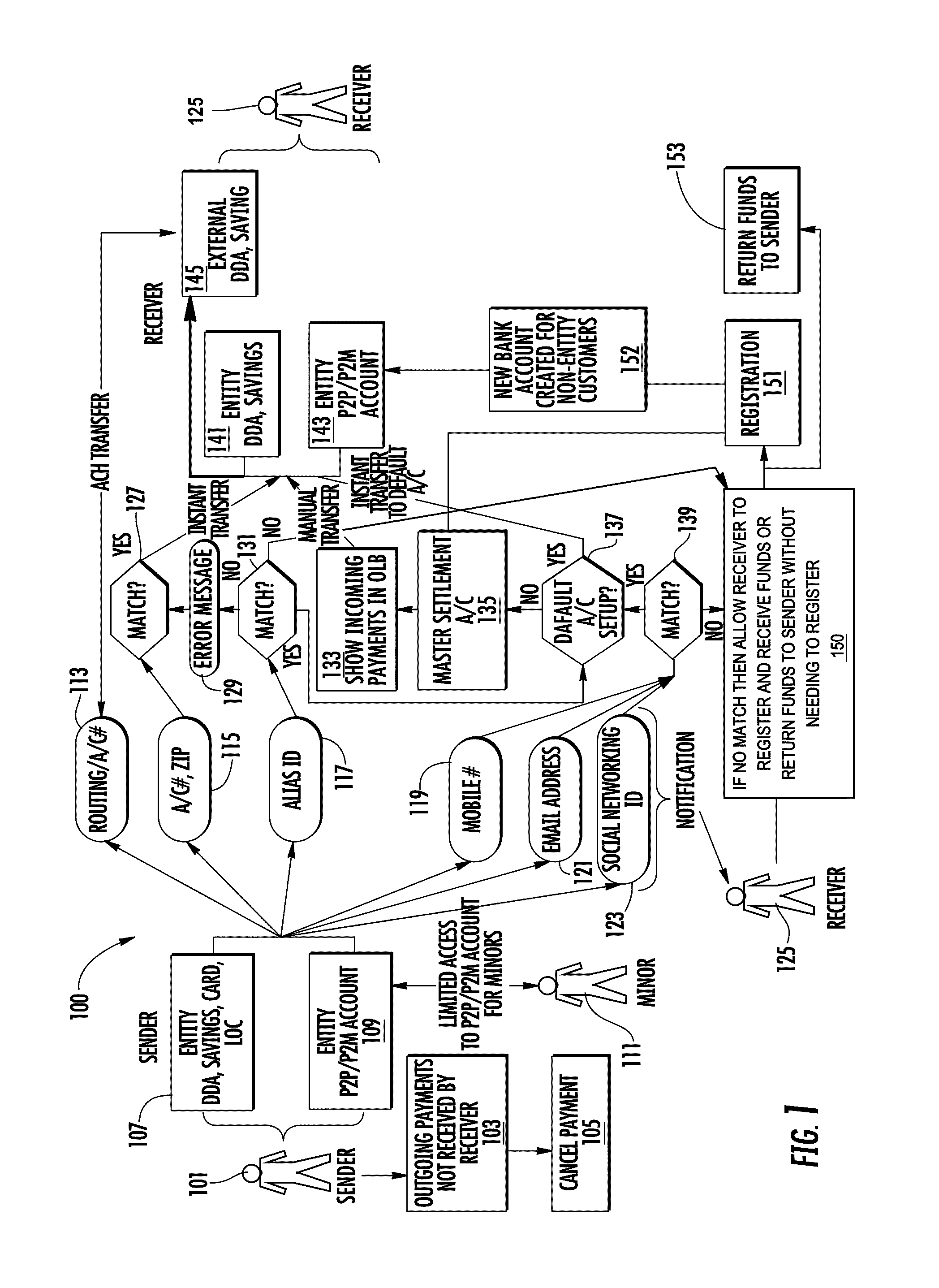

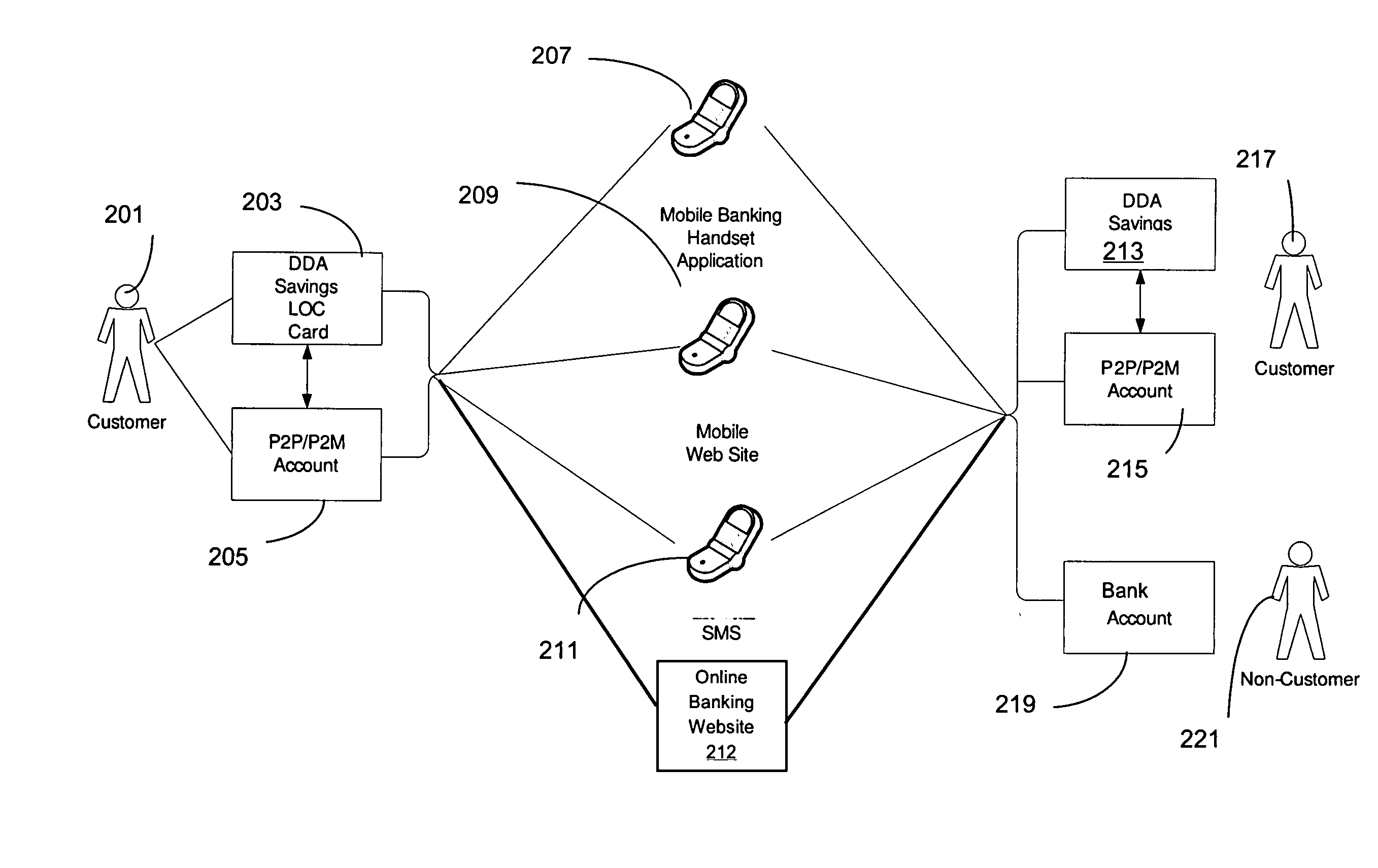

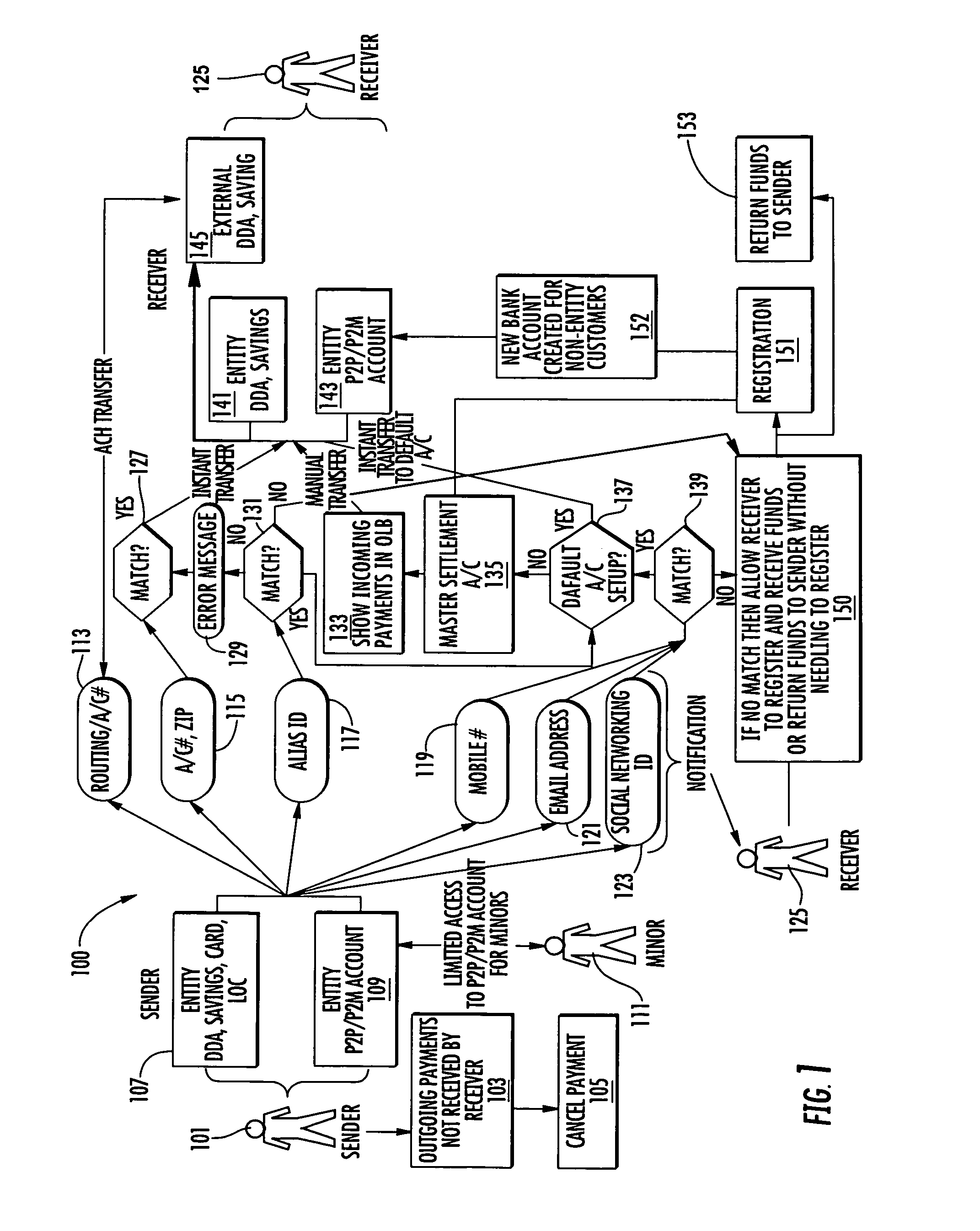

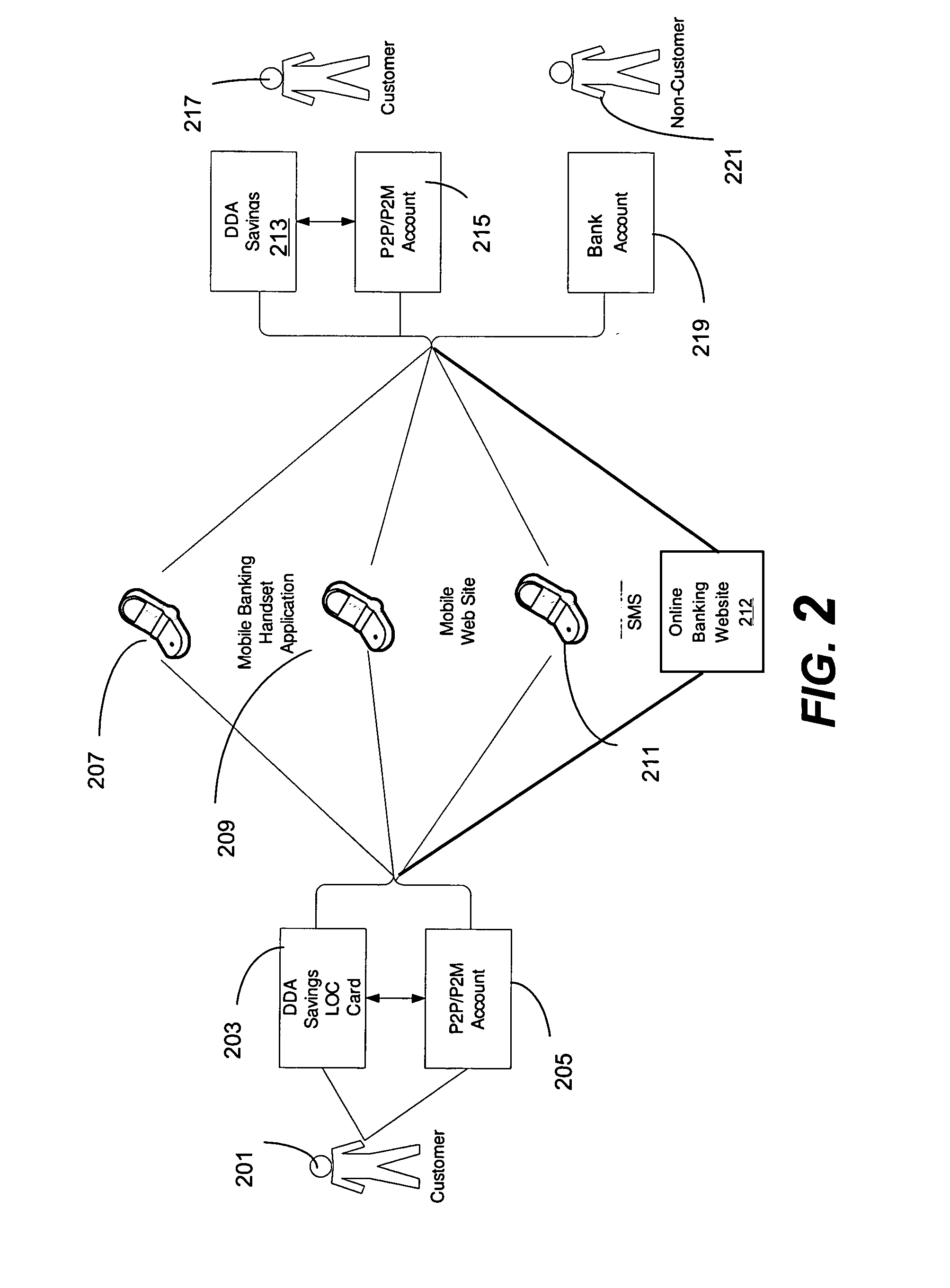

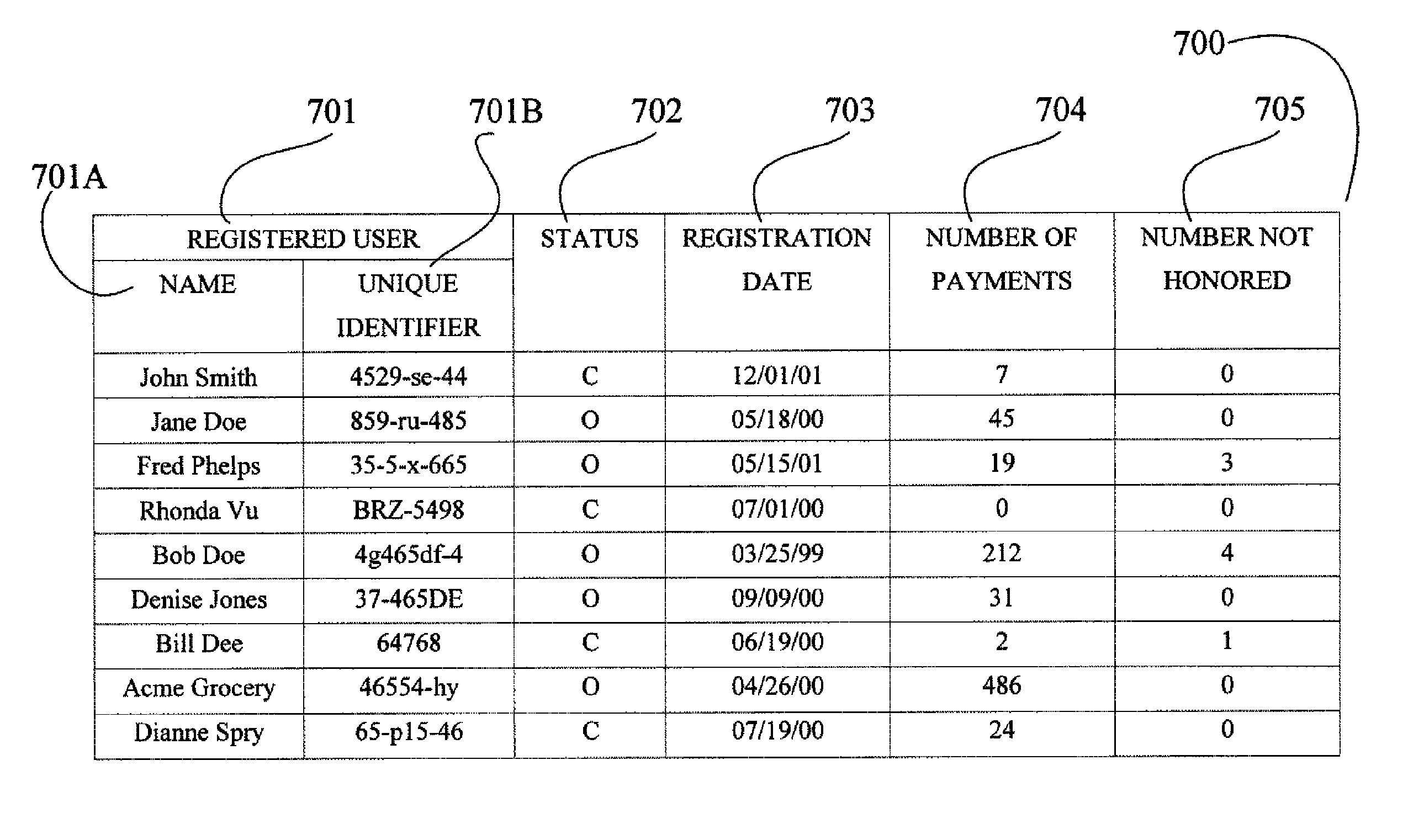

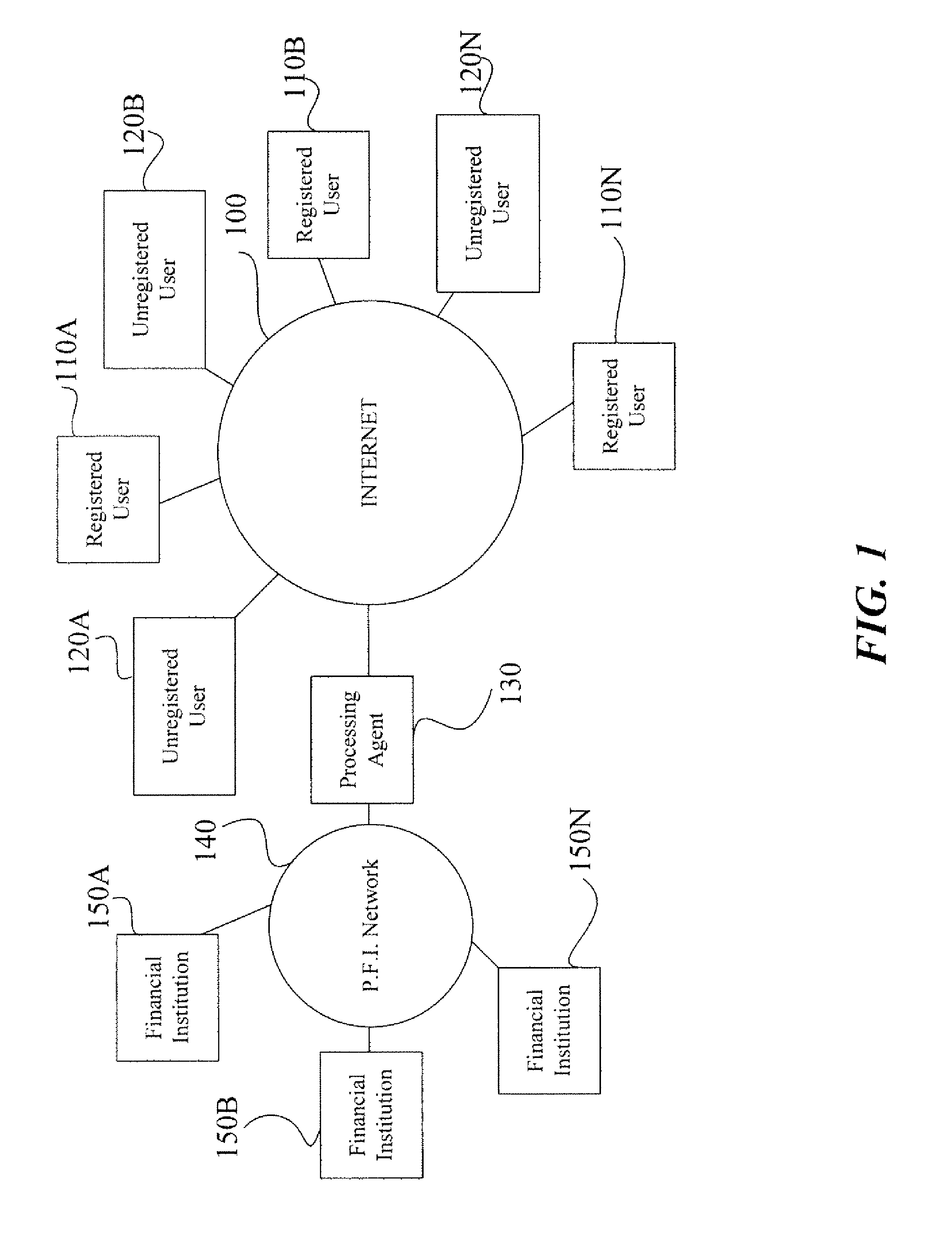

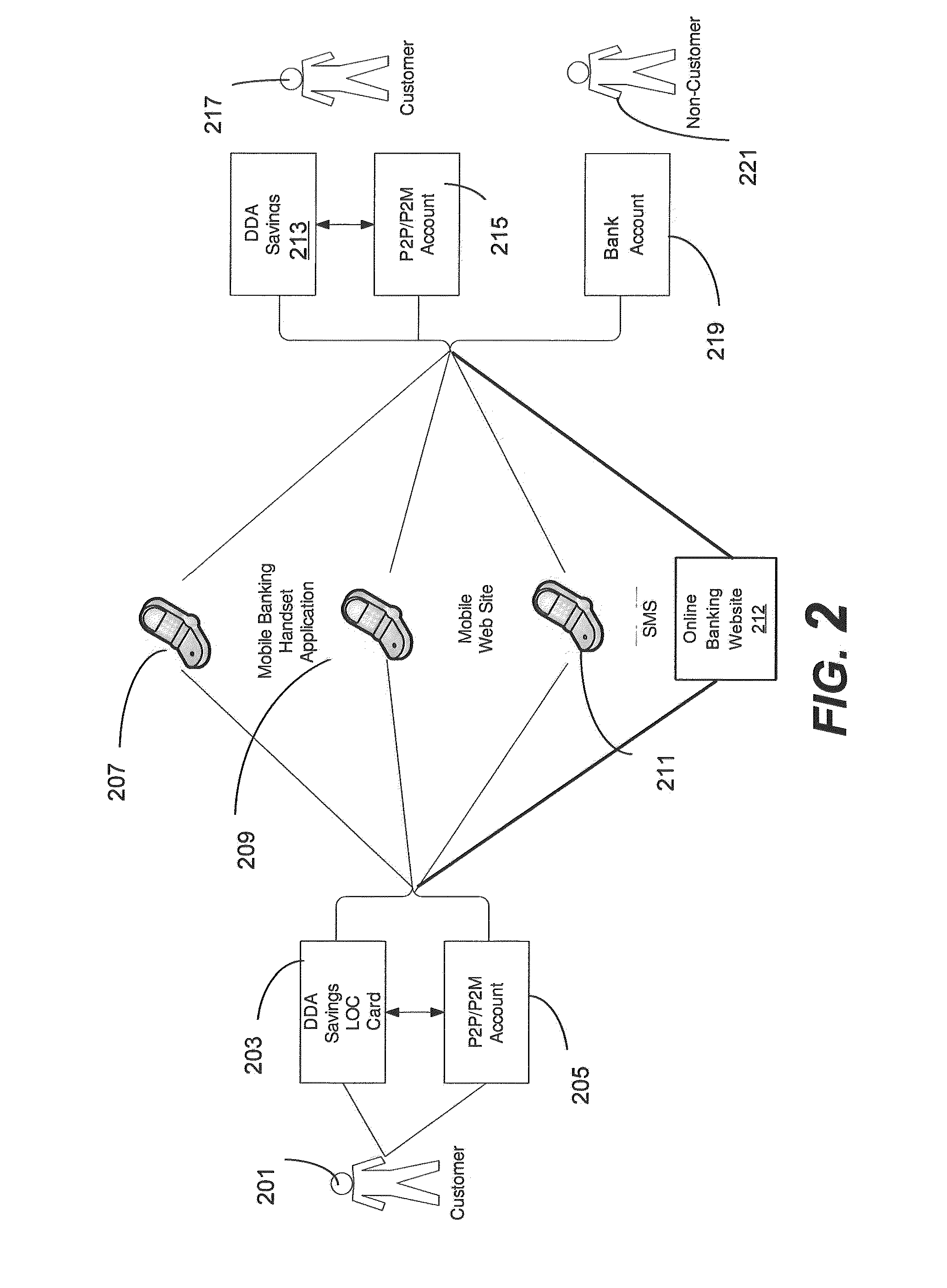

System, method, and computer program product are provided for a user to send and receive P2P payments using a mobile device. Through the use of the mobile device, a user may access his / her accounts at a financial institution and direct payments to a third-party using an alias. The user may ensure a secure payment to a third-party through the network associated with a financial institution. Payments may be directed to individuals the user may input into the system by providing the individual's alias. An alias may be a unique identifier of an individual and tied to a financial account of that individual. The sender of the P2P payments may input the recipient's alias and transfer funds via the P2P payment system without having to input the recipient's account information. This invention allows a user to receive and provide payments for transactions utilizing the convenience of a mobile device.

Owner:BANK OF AMERICA CORP

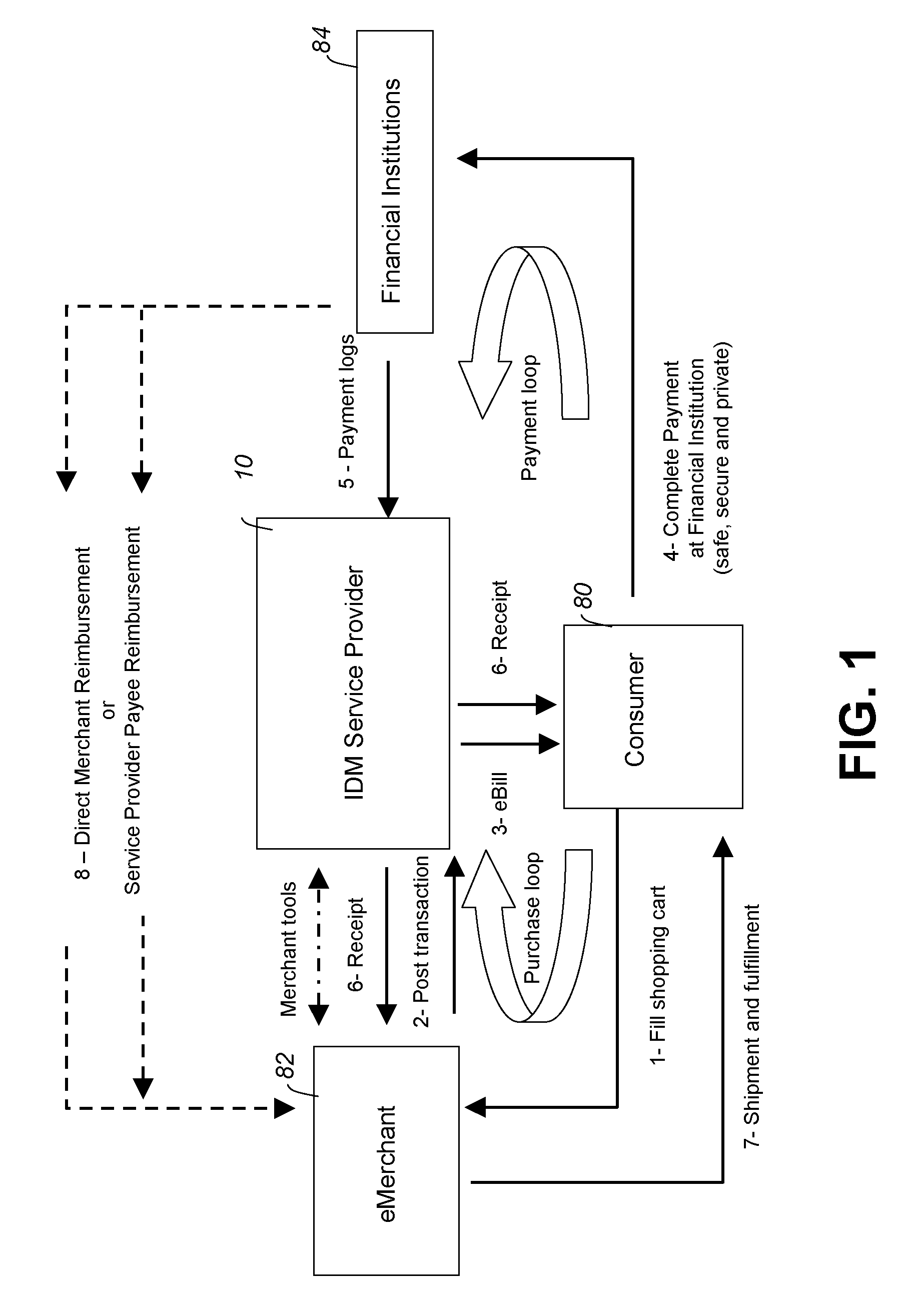

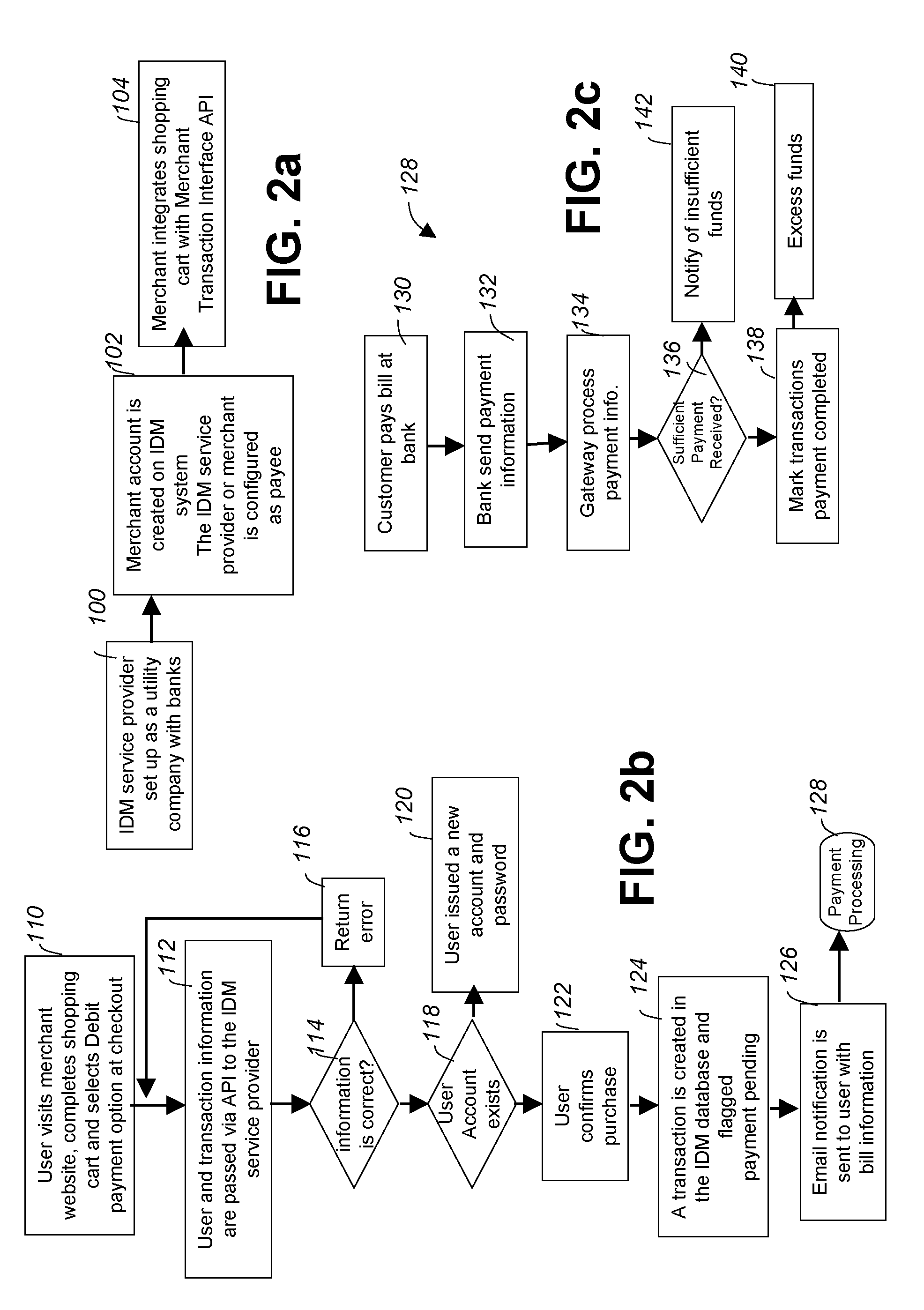

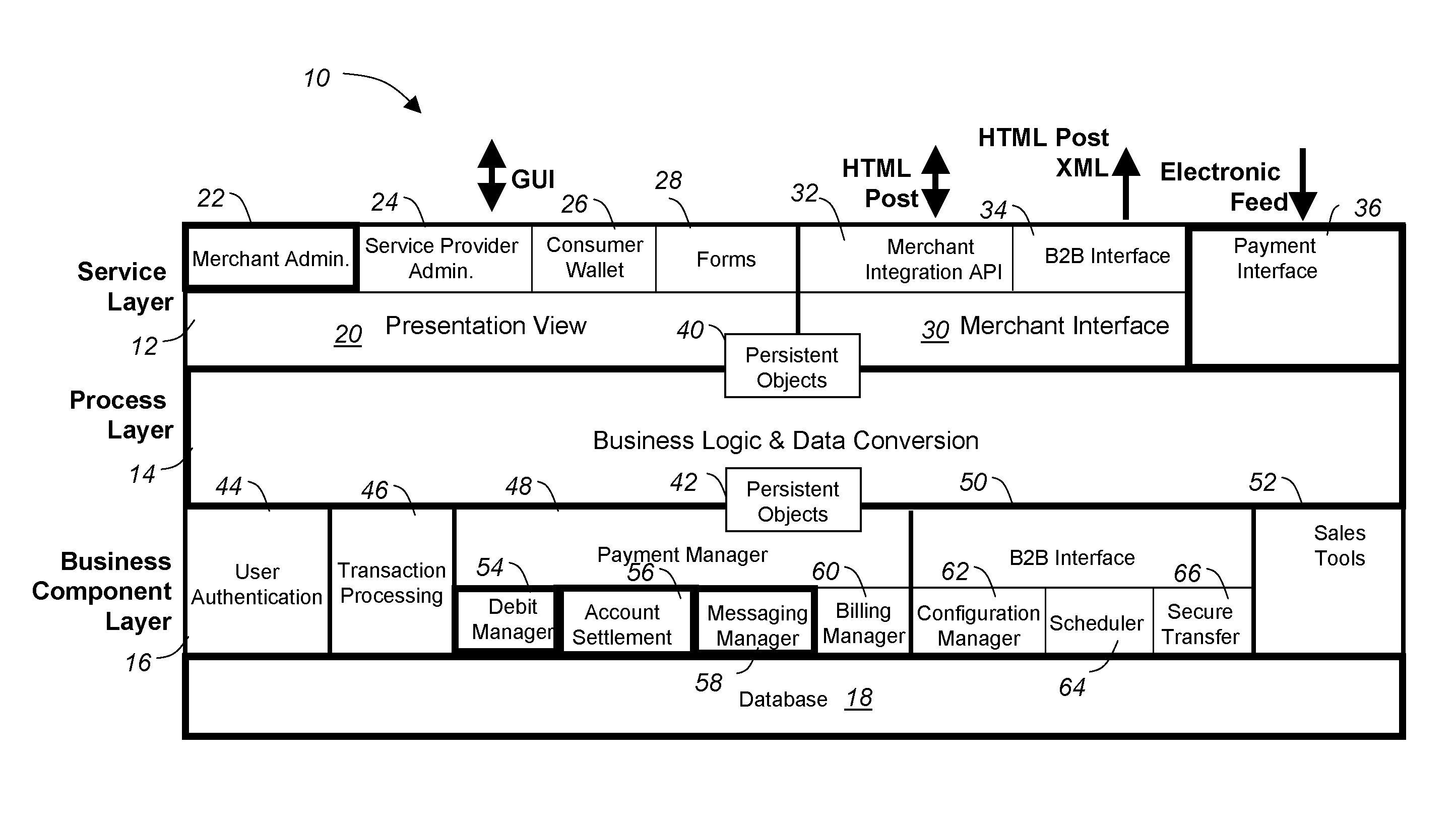

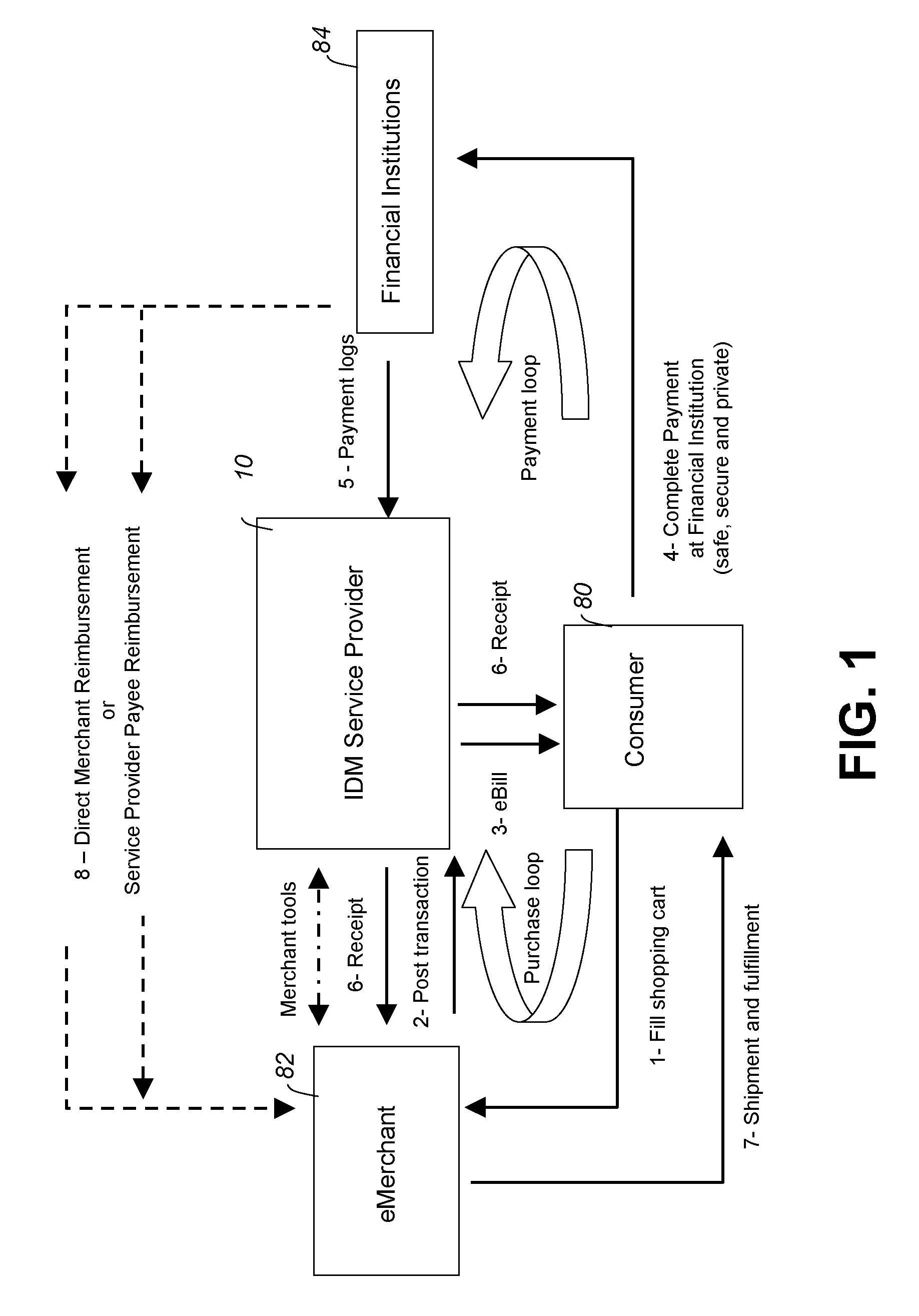

Internet payment system and method

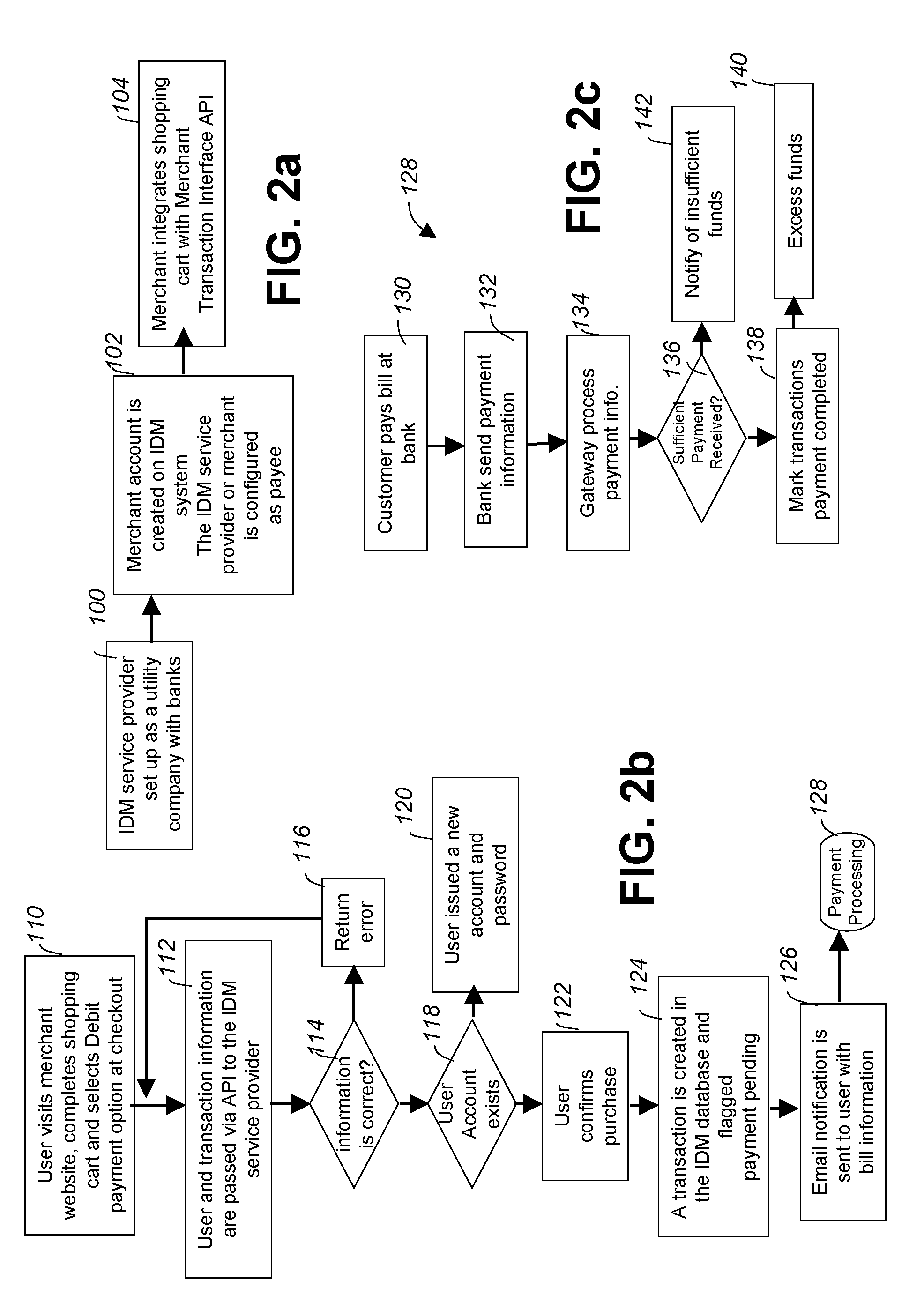

InactiveUS20080114657A1Increase choiceLow costComplete banking machinesFinanceMerchant accountThe Internet

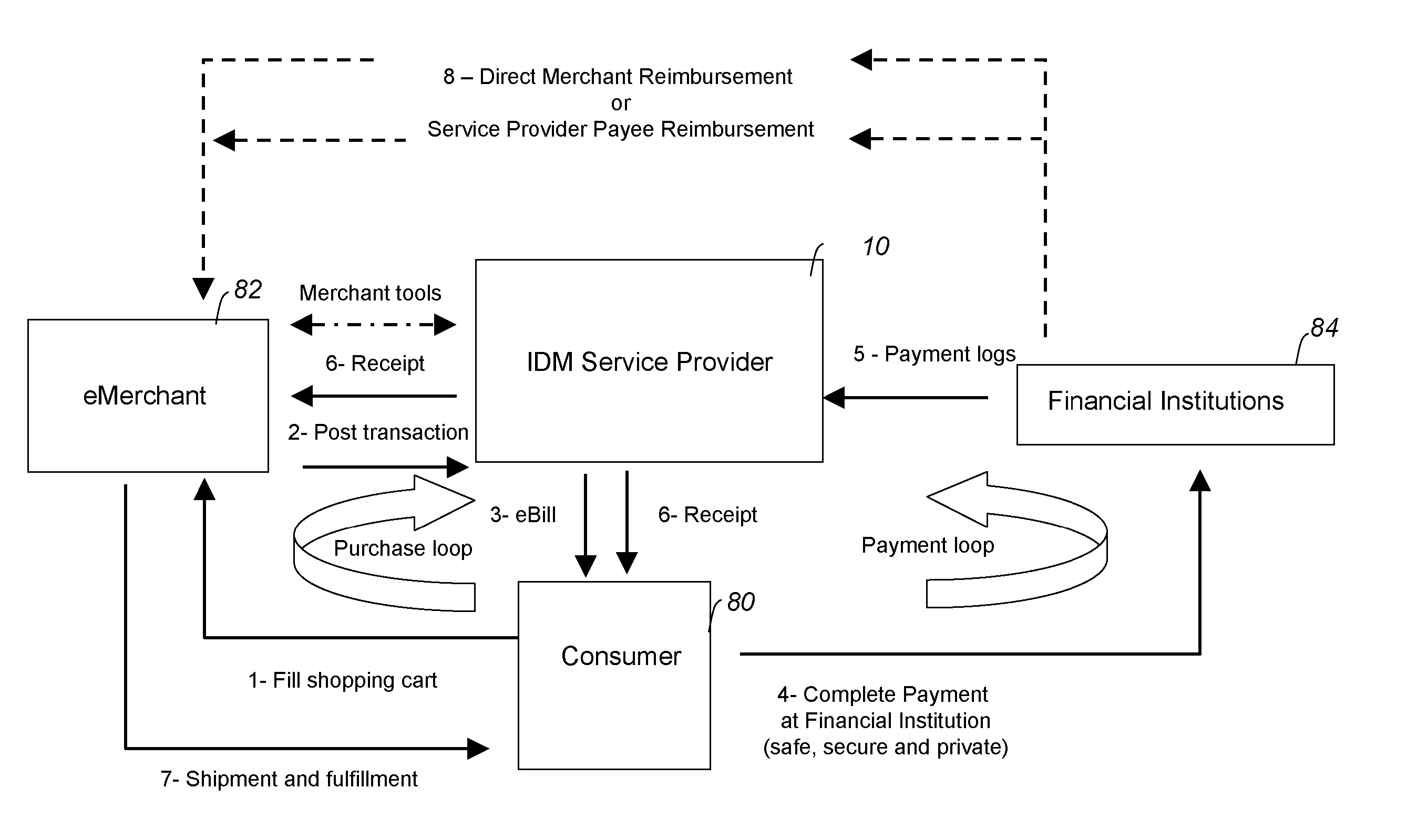

A system and method for facilitating payment for online purchases is disclosed. The system allows consumers / customers who shop online to select, at the time of checkout, direct payment from an account as the payment option. An electronic bill (ebill), independent of any confidential financial information pertaining to the consumer, is automatically displayed and emailed to the consumer. The consumer pays the ebill at their bank the same way they pay their utility bill, which then results in a payment confirmation sent from the bank to the payee. Payment information from the bank is sent to the system to update the purchase transactions. Once the payment information is processed, the consumer and merchant accounts are balanced and both receive automatic notification of the payment.

Owner:WESTERN UNION FINANCIAL SERVICES

Internet payment system and method

InactiveUS8566237B2Increase choiceLow costComplete banking machinesFinanceMerchant accountThe Internet

A system and method for facilitating payment for online purchases is disclosed. The system allows consumers / customers who shop online to select, at the time of checkout, direct payment from an account as the payment option. An electronic bill (ebill), independent of any confidential financial information pertaining to the consumer, is automatically displayed and emailed to the consumer. The consumer pays the ebill at their bank the same way they pay their utility bill, which then results in a payment confirmation sent from the bank to the payee. Payment information from the bank is sent to the system to update the purchase transactions. Once the payment information is processed, the consumer and merchant accounts are balanced and both receive automatic notification of the payment.

Owner:WESTERN UNION FINANCIAL SERVICES

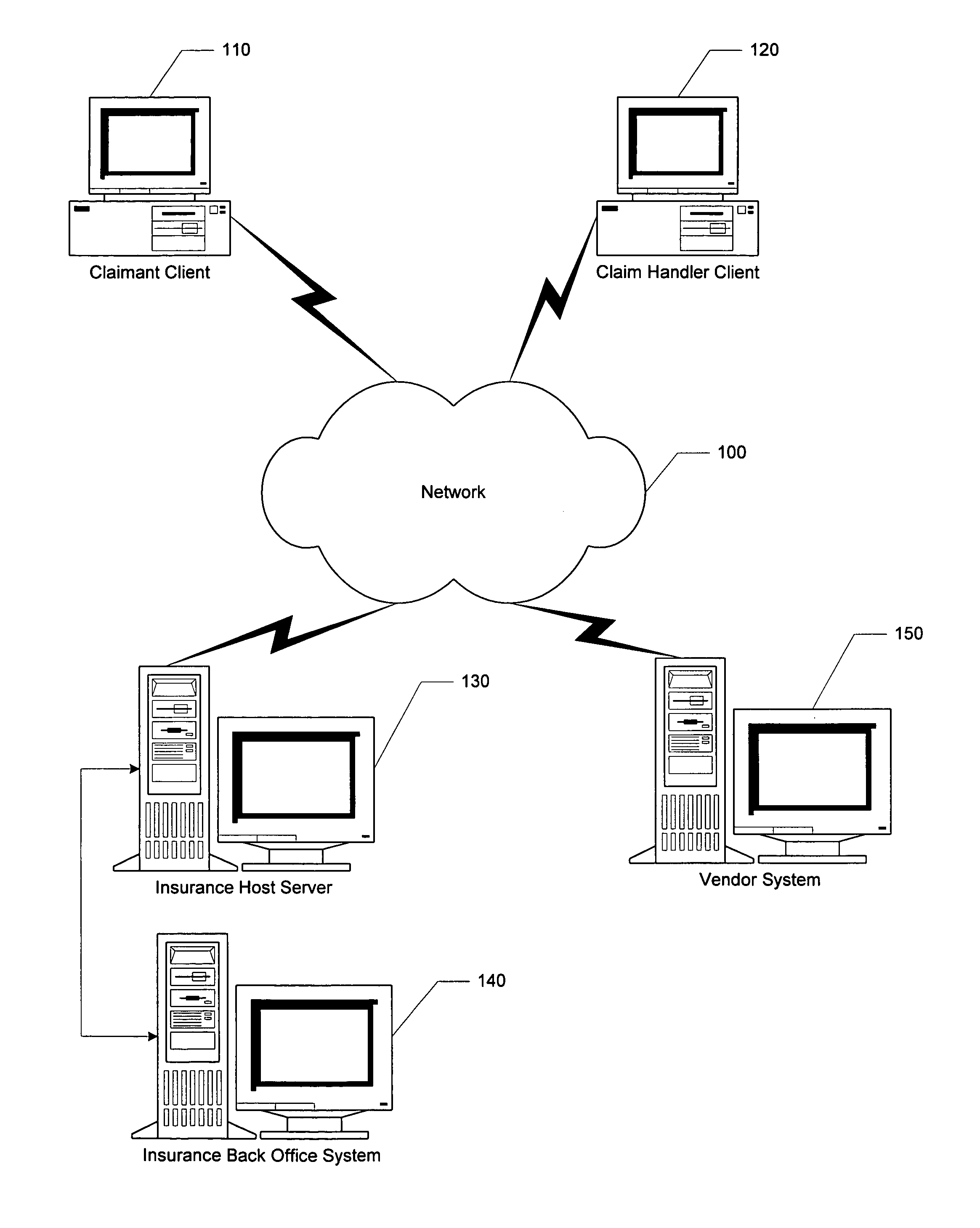

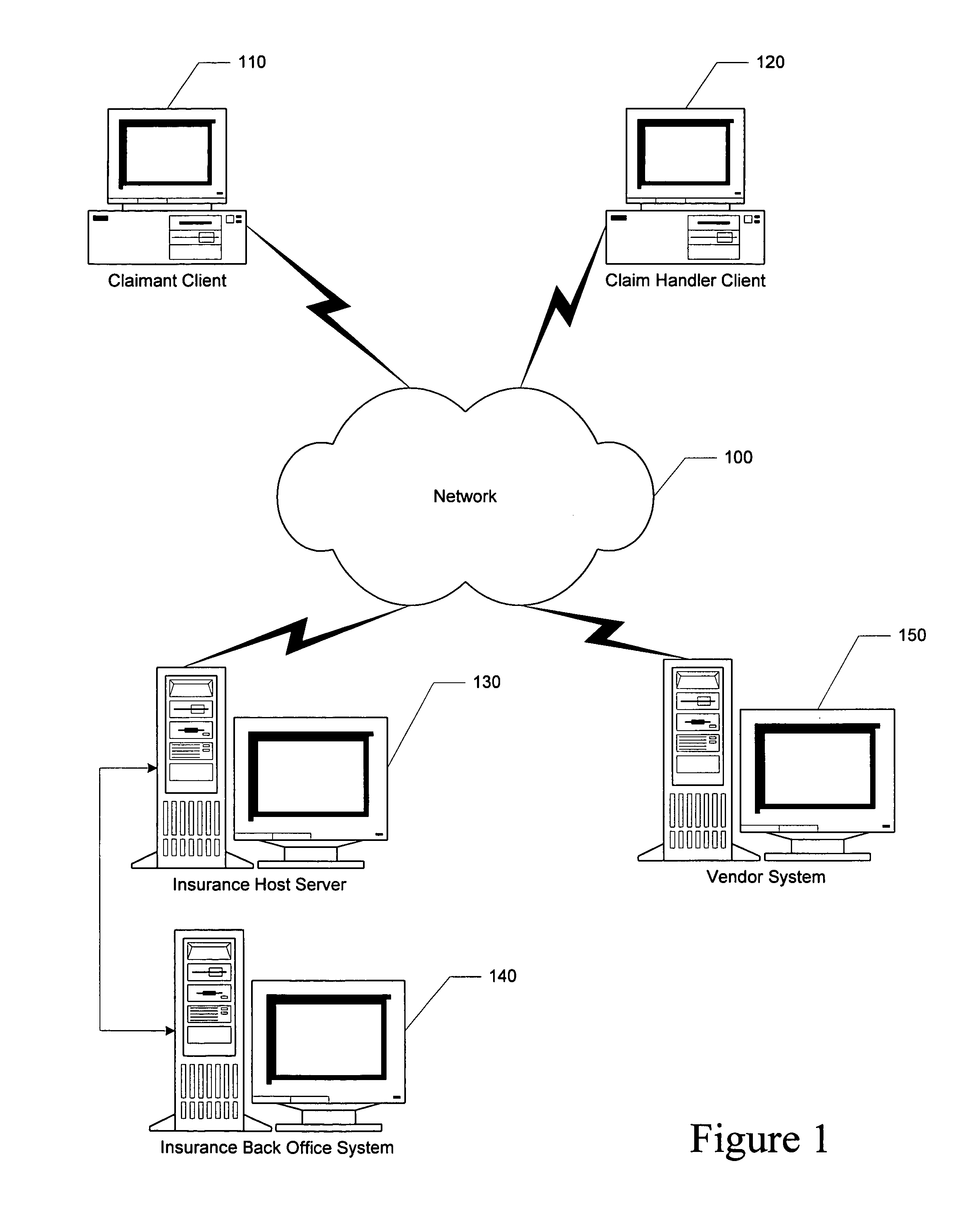

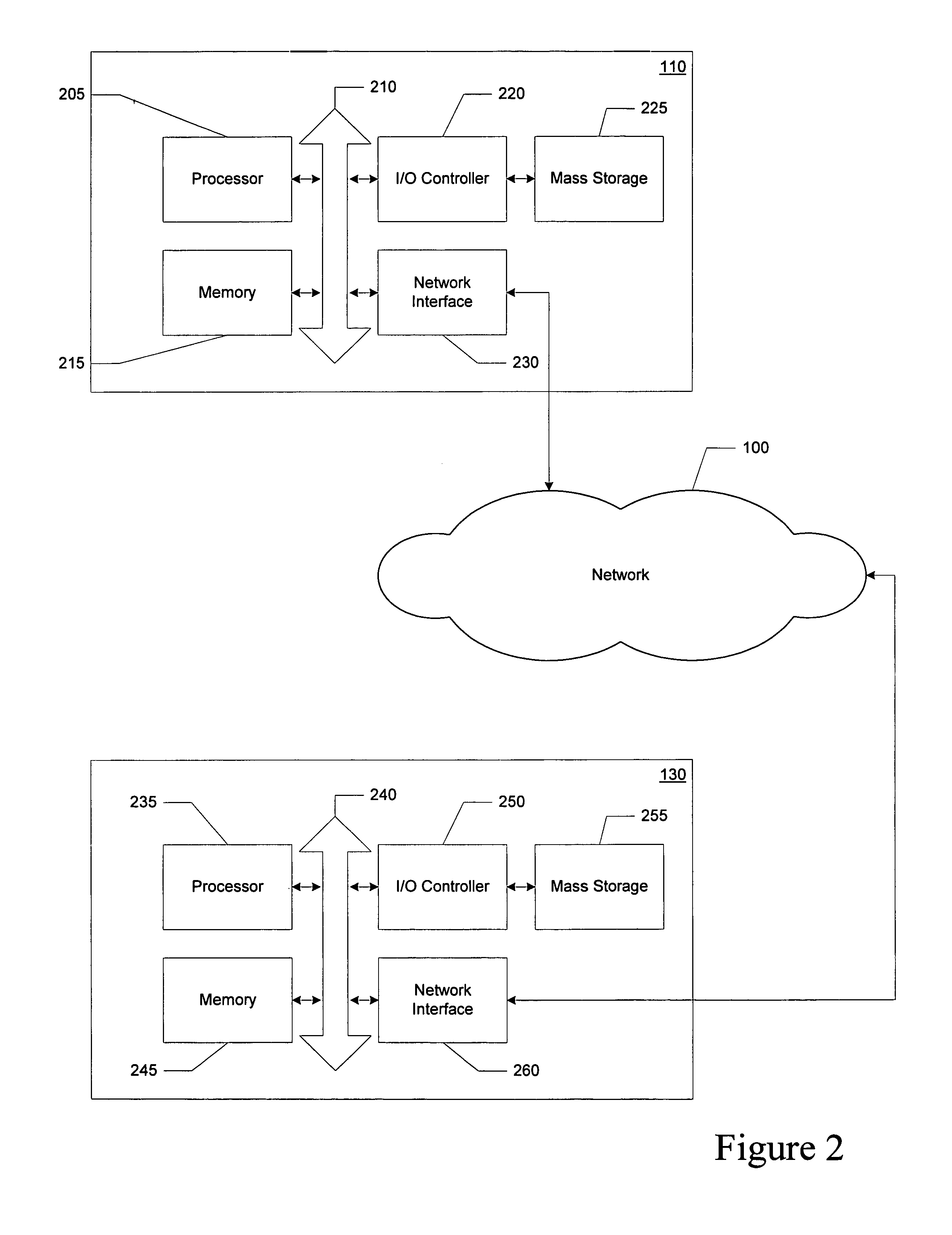

Providing evaluation and processing of line items

Methods, systems, and articles of manufacture consistent with the present invention use a data processing system for evaluating line item data. The method involves displaying at least one line item from a central database; receiving a selection of at least one line item from a claim handler; and receiving authorization from the claim handler to execute payment of the selected line item. The authorization is for either a direct payment, vendor transfer, line item payment, or preauthorized payment.

Owner:DUCK CREEK TECH LTD

Direct payment with token

According to the invention, a method for transferring funds from a payor to one or more payees using a wide area network when the transfer information is incomplete at some point is disclosed. In one step, initial transfer information for a transfer of funds from the payor to the payee is received. In another step, supplemental transfer information for the transfer of funds from the payor to the payee is received. The transfer of funds from the payor to the payee is completed using both the initial transfer information for the transfer of funds from the payor to the payee and the supplemental transfer information for the transfer of funds from the payor to the payee.

Owner:THE WESTERN UNION CO +1

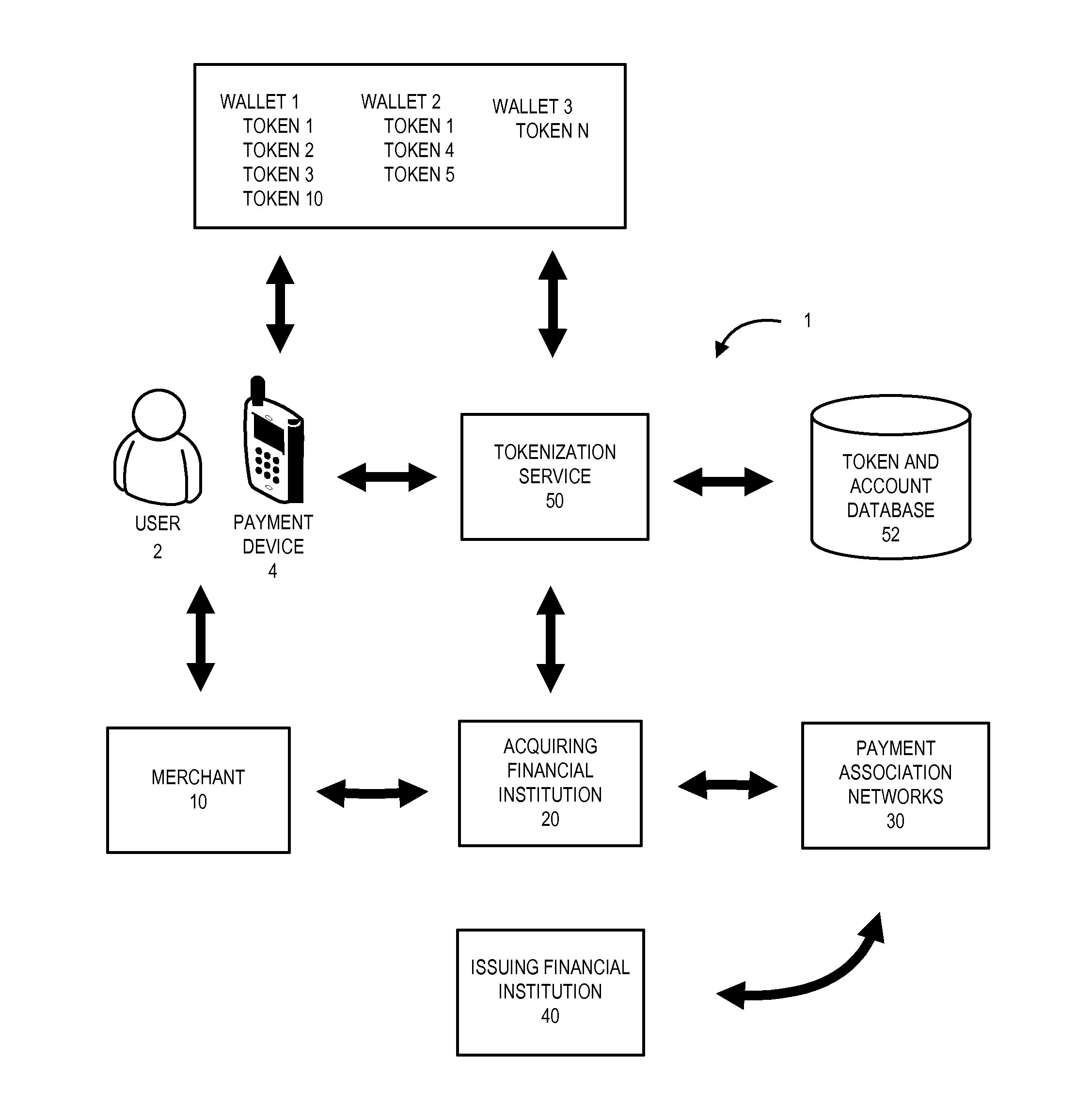

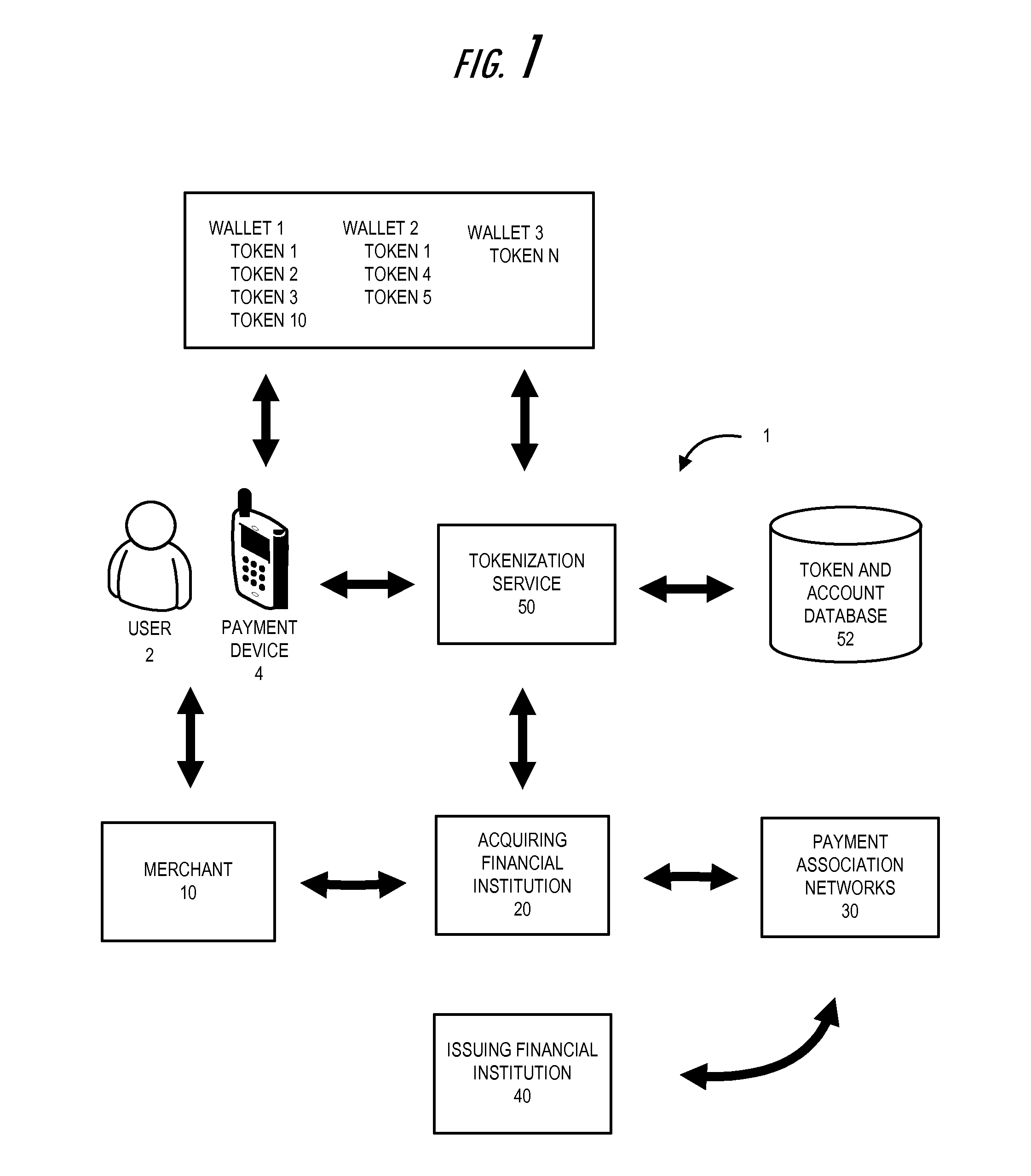

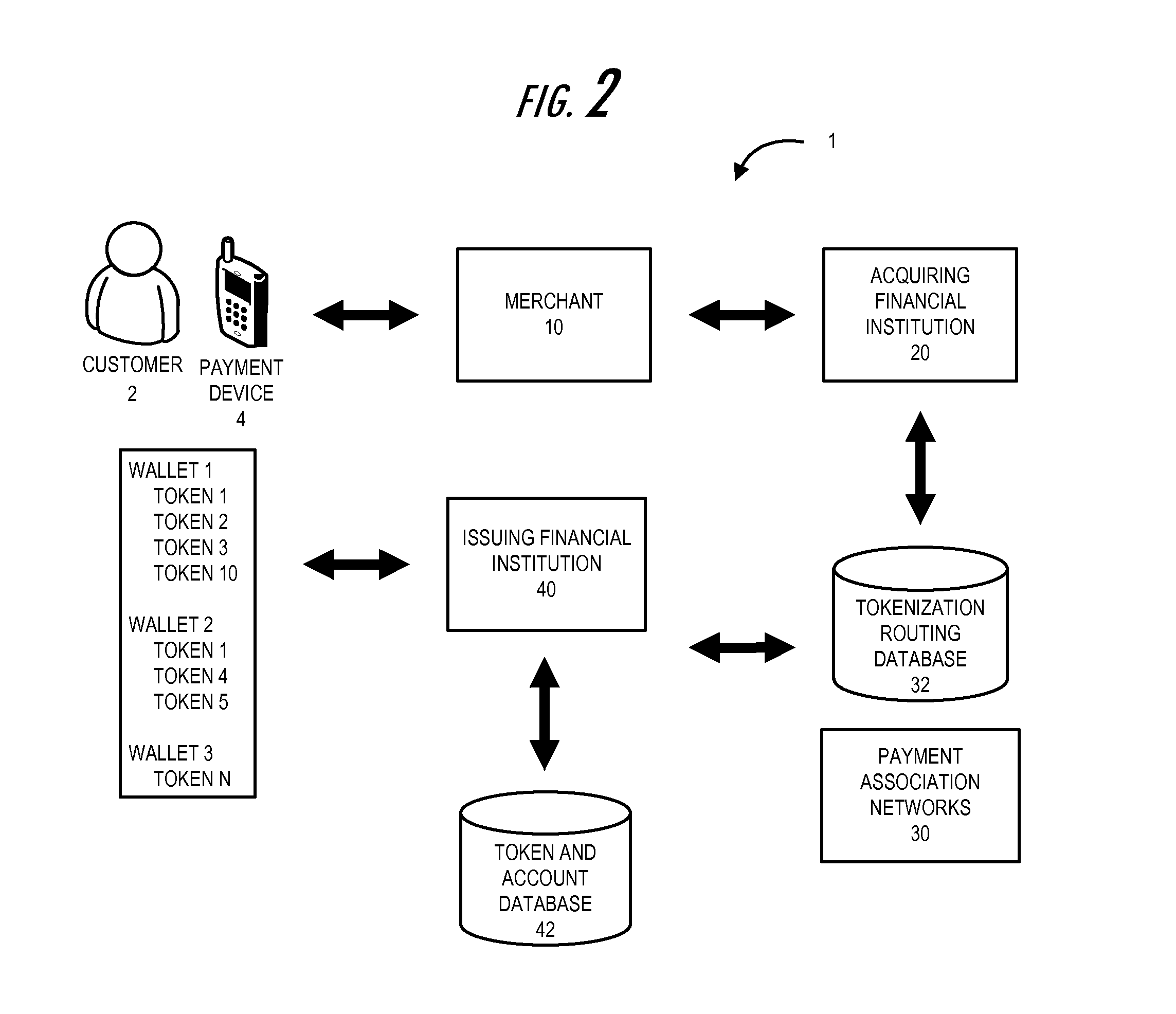

Tokenization of user accounts for direct payment authorization channel

Embodiments of the present invention disclose a financial institution system maintained by a financial institution and for tokenization of user accounts for using a direct payment authorization channel, whereby a third party payment authorization network is avoided. Embodiments establish a direct channel of communication between the system and a merchant or a merchant network in communication with the merchant; wherein the direct channel of communication comprises a network communication channel without a third party payment authorization system; receive a token issued by the financial institution and associated with a user account associated with a customer of the financial institution; receive transaction data comprising an amount associated with a transaction between the customer of the financial institution and the merchant; and determine whether to authorize the transaction based on the received token and the received transaction data.

Owner:BANK OF AMERICA CORP

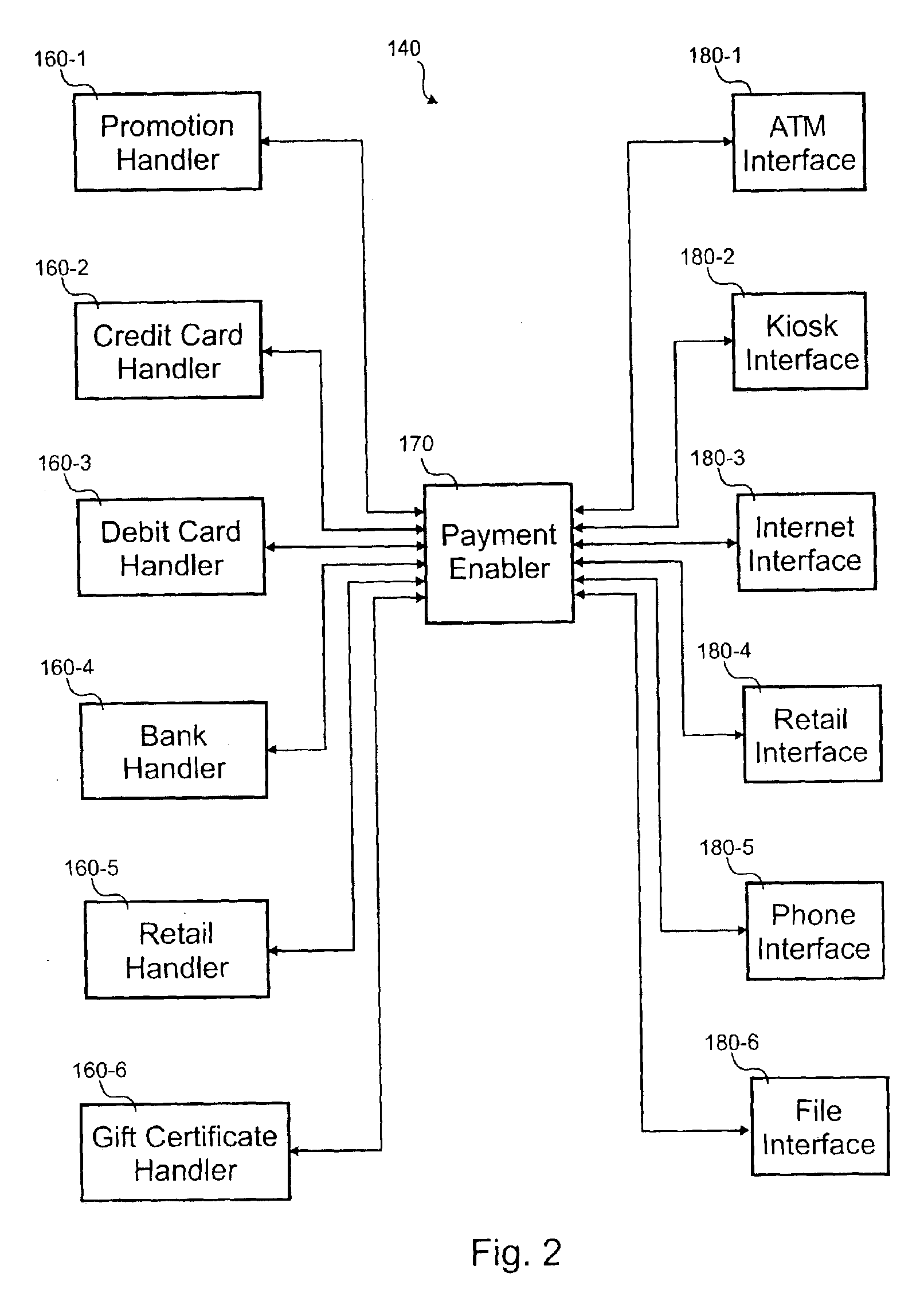

Method and system for payment processing

ActiveUS7953660B2Easy to implementEasy programmingFinanceBilling/invoicingComputer networkDirect Payments

The present invention provides a method, system, and article of manufacture for providing payment services on a network. Information identifying a network user is received. The network user is assigned a payer status. A request to make a payment to a payee on behalf of the network user is received. If a first payer status is assigned to the network user, the payment will be made no matter the identity of the payee. If a second payer status is assigned to the network user, the payment will only be made if the payee is one of a group of payees that is not determined by the network user. With the second payer status, the network user can only direct payments to the group of payees. The payer status can be changed from one payer status to another payer status.

Owner:CHECKFREE SERVICES CORP

Online payment system and method

ActiveUS20120116973A1User-friendly interfaceEasy to monitorFinanceProtocol authorisationThird partyInternet privacy

System, method, and computer program product are provided for a user to send and receive P2P payments using the Internet. Through the use of a network, a user may access accounts the user has at a financial institution and direct payments to other individuals or entities using the other individuals or entities alias. In this way, the user may ensure a secure payment to a third-party through the network associated with a financial institution. The payments may be directed to individuals the user may input into the system by providing the user's alias. A user's alias may be a unique identifier of the user and tied to a financial account of that user. In this way, the sender of the P2P payments may input the recipient's alias and transfer funds via the P2P payment system without having to input the recipient's account information.

Owner:BANK OF AMERICA CORP

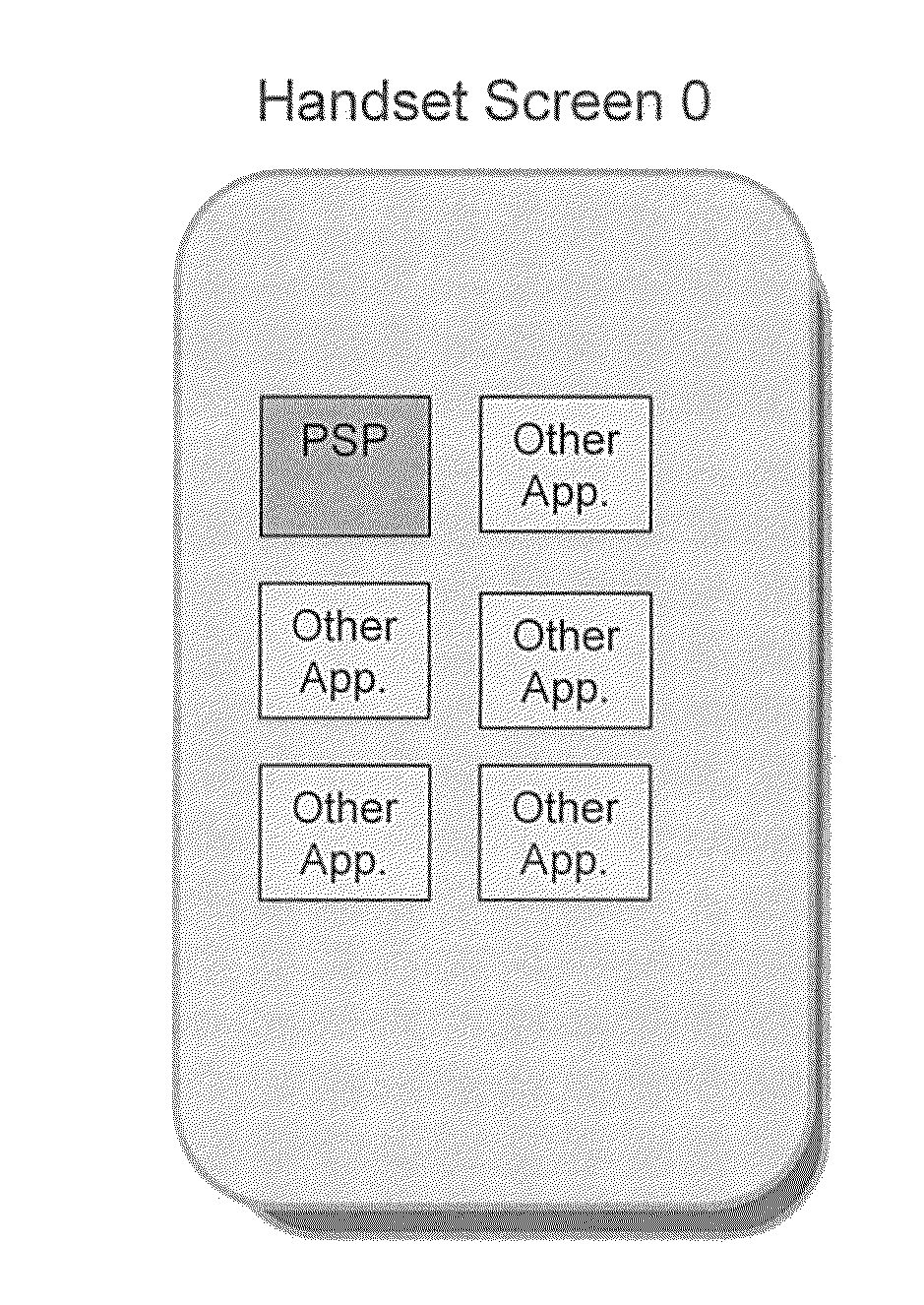

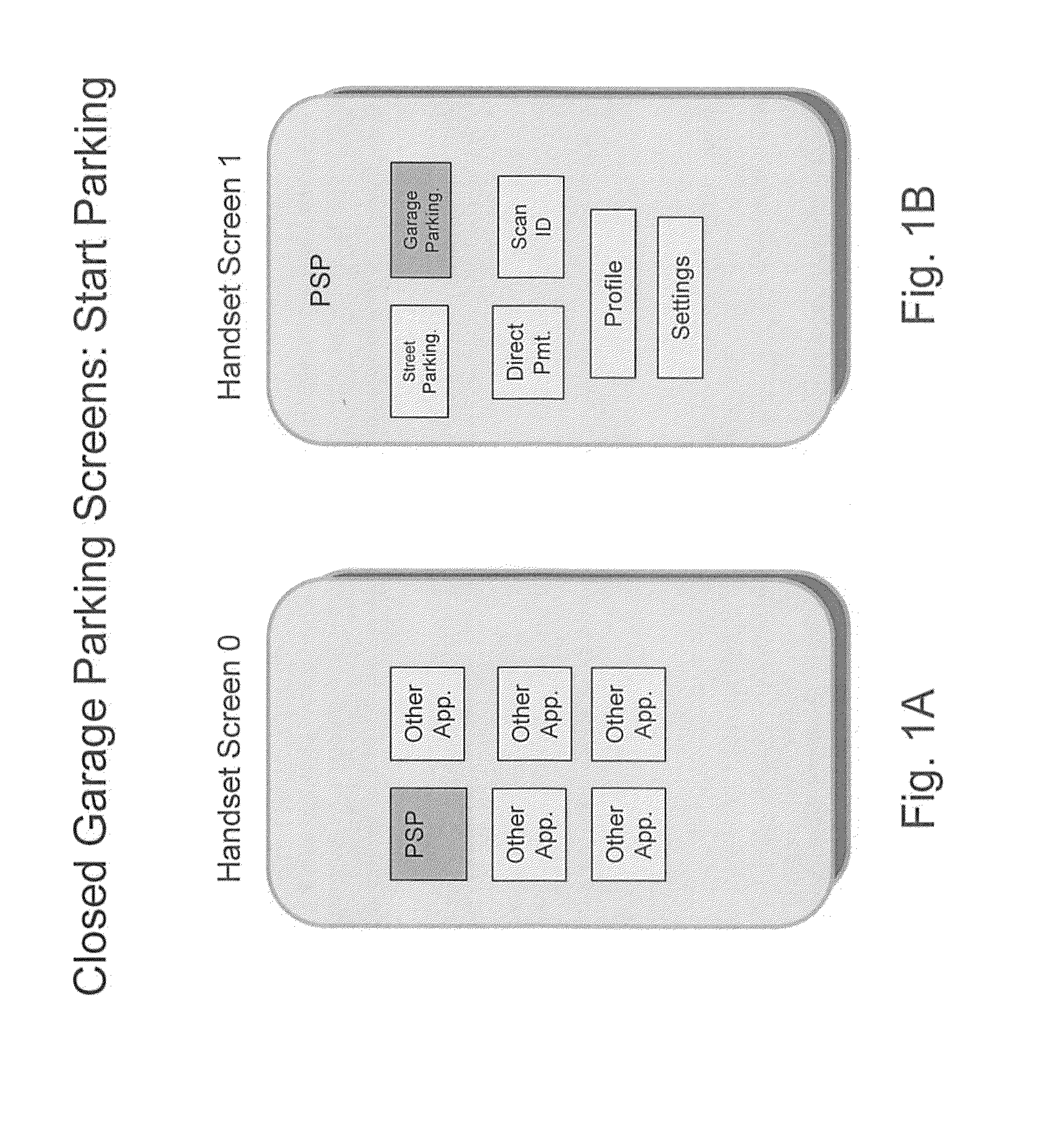

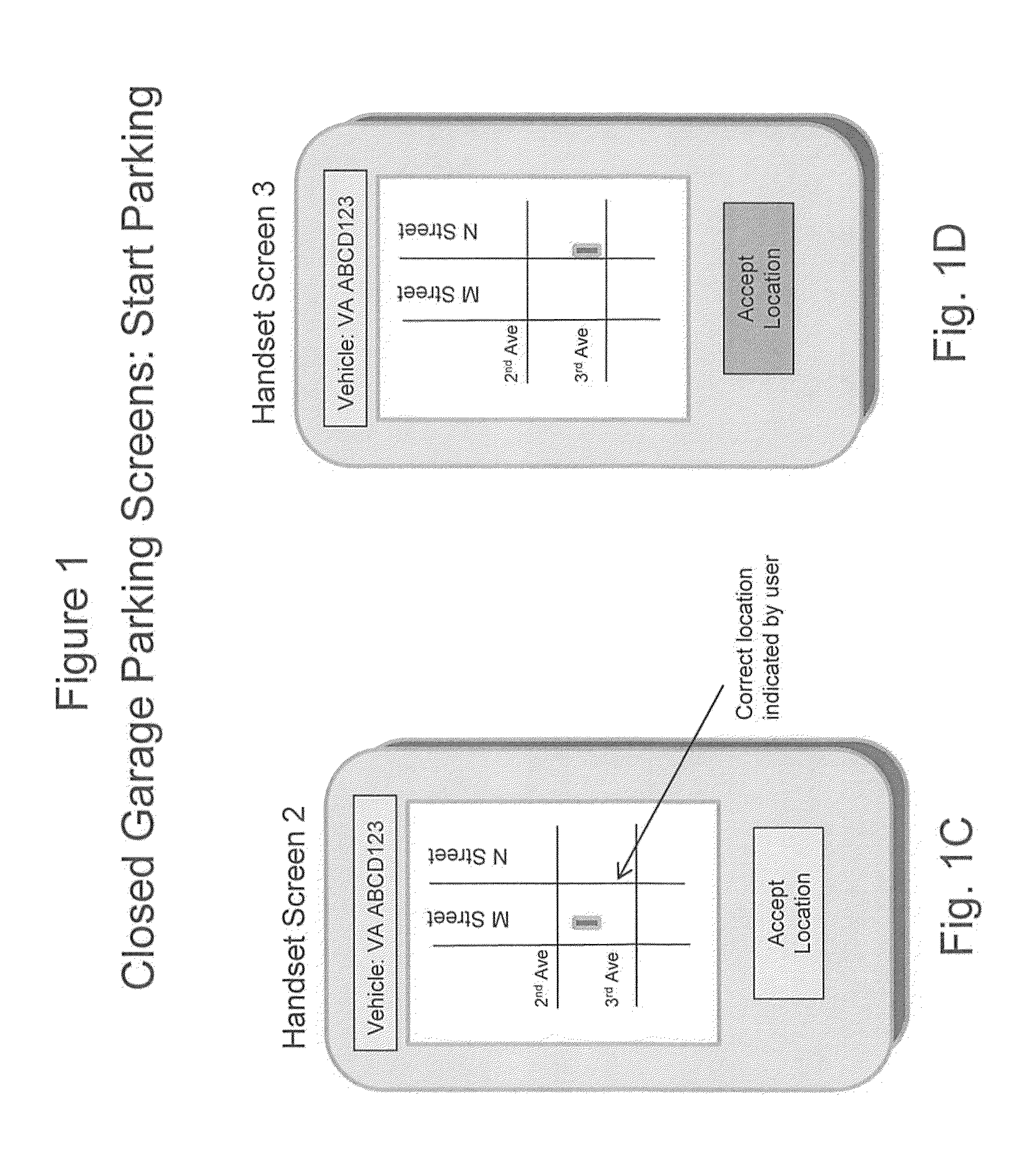

Methods and systems for electronic payment for parking in gated garages

ActiveUS20150025947A1Improve securityMinimize disruptionTicket-issuing apparatusRoad vehicles traffic controlDirect PaymentsComputer science

The methods describe the use of Handset Apps in garages currently using paper tickets or ID tokens in ways that minimize disruption to the existing infrastructure. The techniques include automatic recognition of garage / gate ID, automatic identification of paper ticket ID without optical scanning, and direct payment in manually operated garages, including those using valet parking.

Owner:TRANSPARENT WIRELESS SYST

Express easy-pass checkout at grocery stores and retail establishments for preferred members

A grocery store or retail establishment easy-pass (E-Z) lane system for enabling express non-contact payment of a plurality of items is presented including an E-Z pass express checkout lane having at least a scanner for scanning the plurality of items and provided exclusively to preferred members pre-registered with the grocery store or retail establishment. The system includes an RFID antenna positioned about the E-Z pass express checkout lane for communicating with an RFID transponder issued to a preferred member when the RFID transponder is in close proximity to the RFID antenna. The E-Z pass checkout lane is activated thereafter for use by the preferred member for express checkout without the preferred member furnishing direct payment at the E-Z pass express checkout lane via a personal payment account that is separate and distinct from a prepaid vendor-established and maintained purchasing account.

Owner:KOUNTOTSIS THEODOSIOS +1

Electronic documents for person to person payment

InactiveUS20150134507A1User-friendly interfaceConvenient registrationFinanceProtocols using social networksElectronic documentInvoice

System, method, and computer program product are provided for a user to send and receive P2P payments using a mobile device. Through the use of the mobile device, a user may access accounts the user has at a financial institution and direct payments to other individuals or entities using the other individuals or entities alias. Electronic document(s) may be communicated in conjunction with a payment and / or request for payment between financial institutions. For example, a sending financial institution may send a payment having a document or pointer to a document that provides an explanation of a payment or disbursement. The sender may send funds to a recipient along with a pointer or may simply send a pointer and upload a document that is stored at a location identified by the pointer. The document may be an invoice remittance, explanation of payment / reimbursement and / or explanation of benefits.

Owner:BANK OF AMERICA CORP

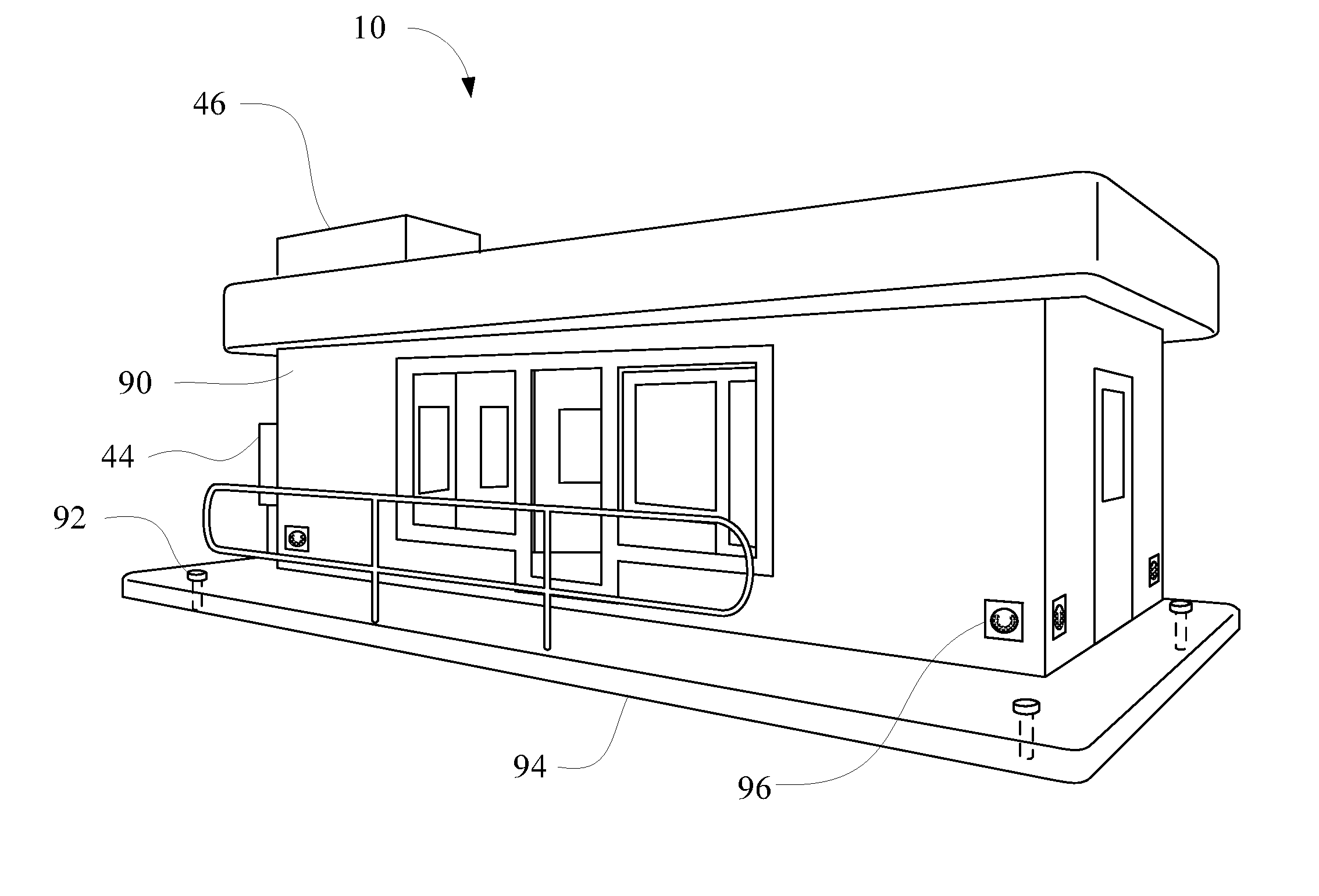

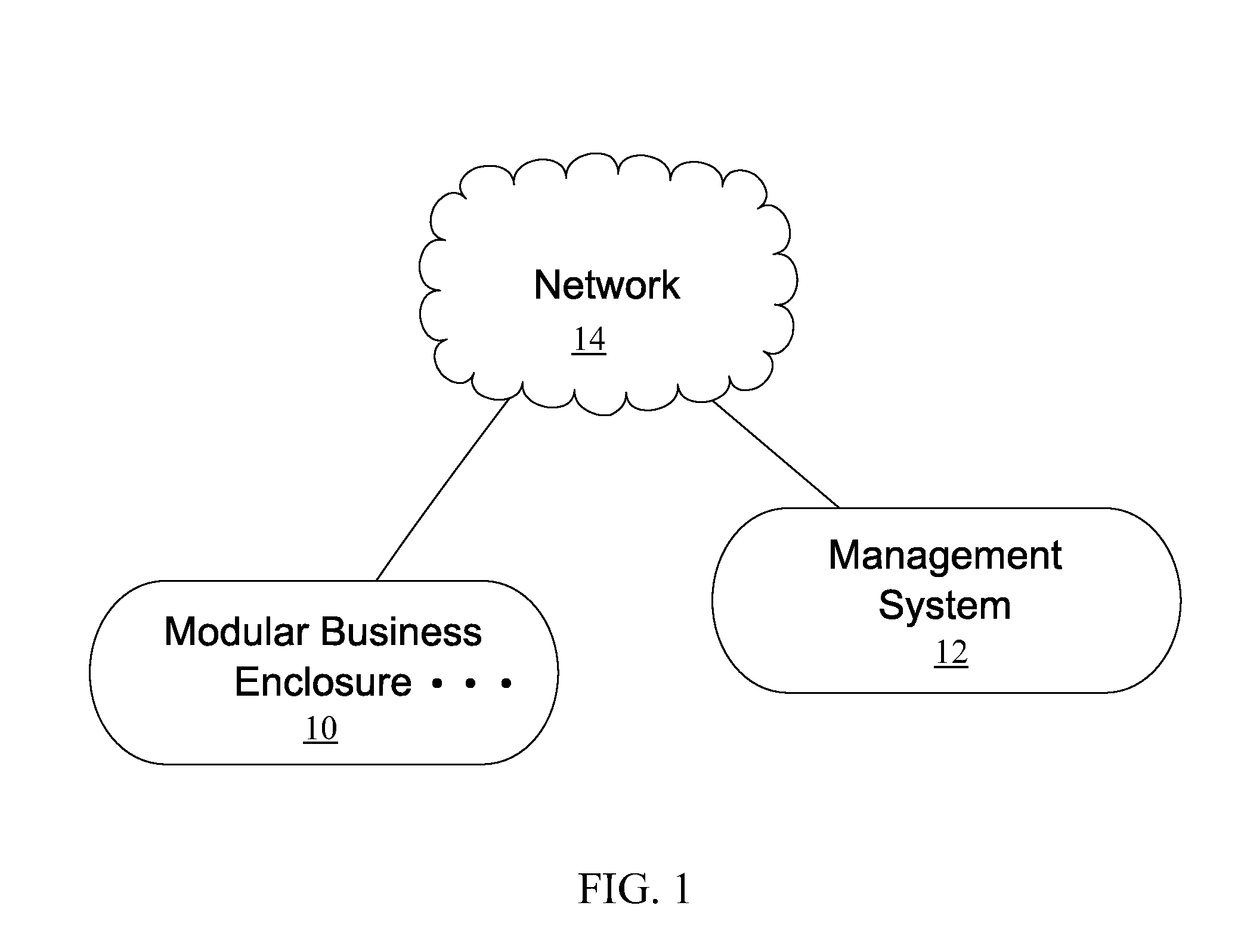

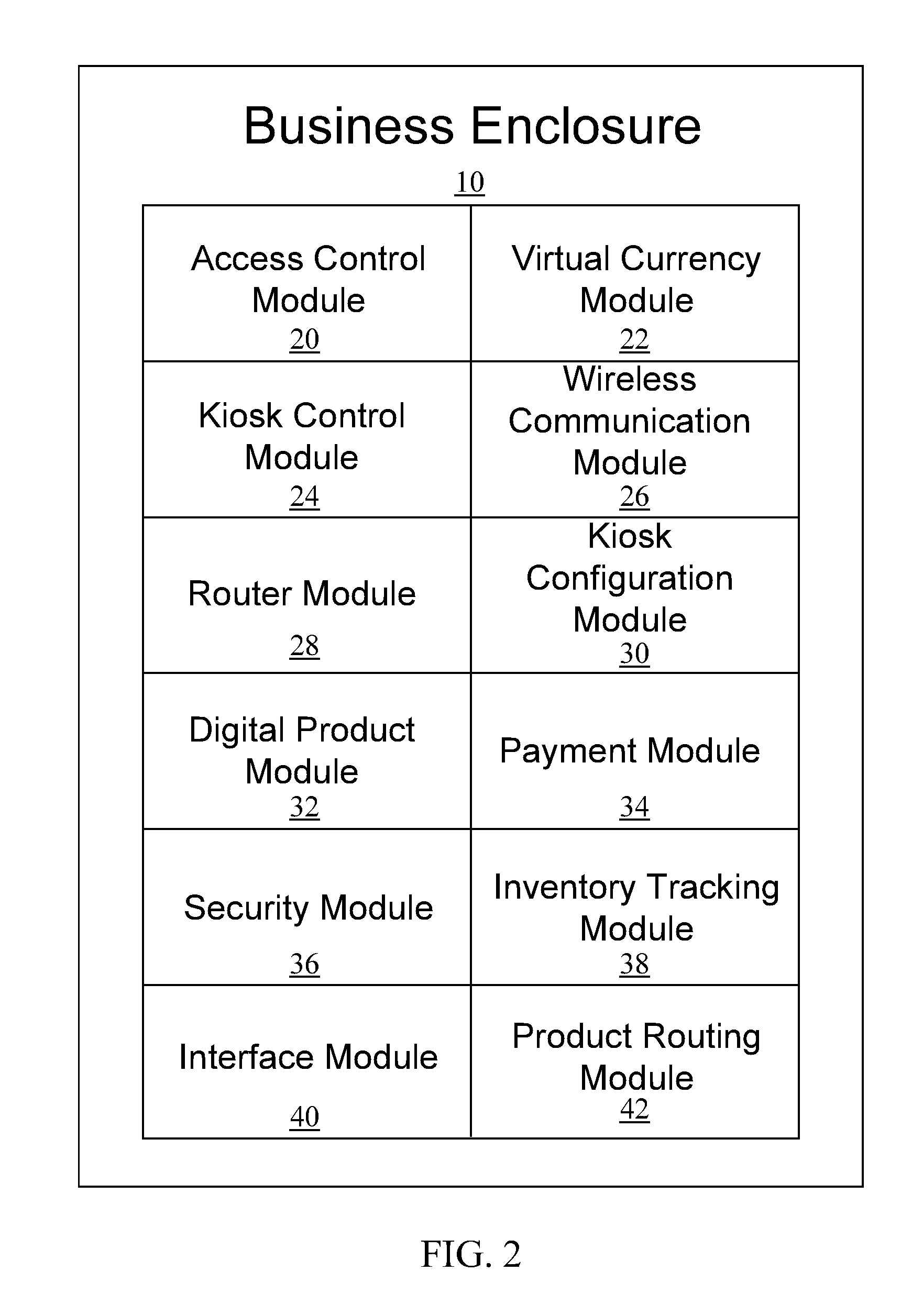

Business enclosure

There is a business enclosure configured to provide easily deployed automated business services to a region. The business enclosure includes a shelter structure, not including any plumbing and configured to provide power and communication thereto. The shelter structure includes a communication module configured to communicate with a remote computerized network. The shelter structure includes a recognition module configured to provide facial recognition capabilities of customers thereof. The shelter structure includes a self-service financial transaction module configured to permit users to provide direct payments to target individuals with a financial account. The business enclosure includes an automated business service kiosk configured to provide business services to customers. The automated business service kiosk includes a single robotic dispensing module servicing a plurality of customer interface modules.

Owner:ABLIN LANCE

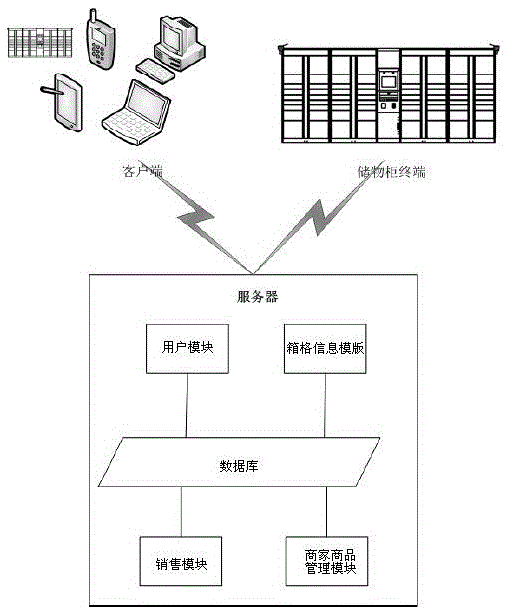

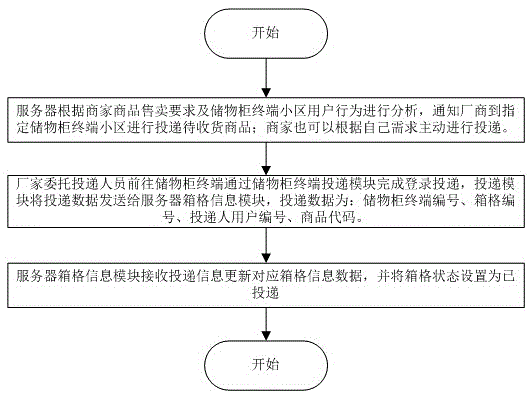

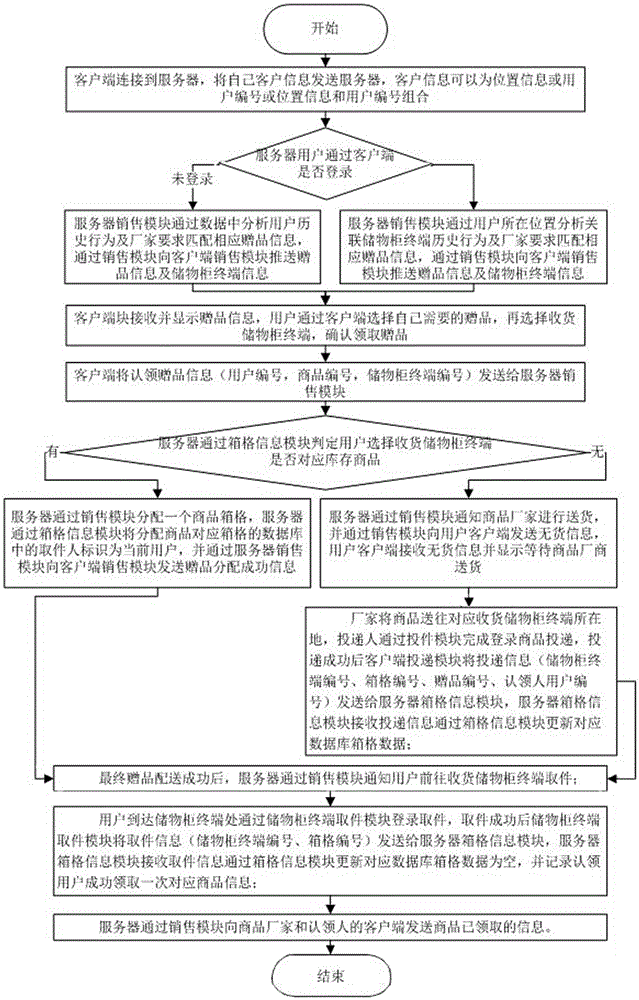

Locker system for directional giving and selling and method thereof

InactiveCN105631723AIncrease the use of functionsQuick selectionDiscounts/incentivesApparatus for meter-controlled dispensingDirect PaymentsPurchasing process

The invention discloses a locker system for directional giving and selling and a method thereof. A merchant delivers a to-be-taken present or a to-be-sold goods to a locker terminal; a corresponding to-be-taken present or a corresponding to-be-sold goods is directionally pushed to a client trough a server; the user confirms taking or buying through the client, the user selects a corresponding locker terminal for getting the goods, and taking or buying is completed. During the series of process, the system greatly expands the use function of the existing locker terminal; precise goods pushing and a goods getting-while-buying function are completed through the locker terminal, the use is quick and convenient, the user can directly get the goods while seeing the goods, if the goods needs to be paid, direct payment can be carried out through the locker terminal to complete the buying process, if the goods is given as a present, payment is not needed, and if the goods is pre-stored, goods payment can be completed in a real time mode.

Owner:CHENGDU WOLAILA GRID INFORMATION TECH

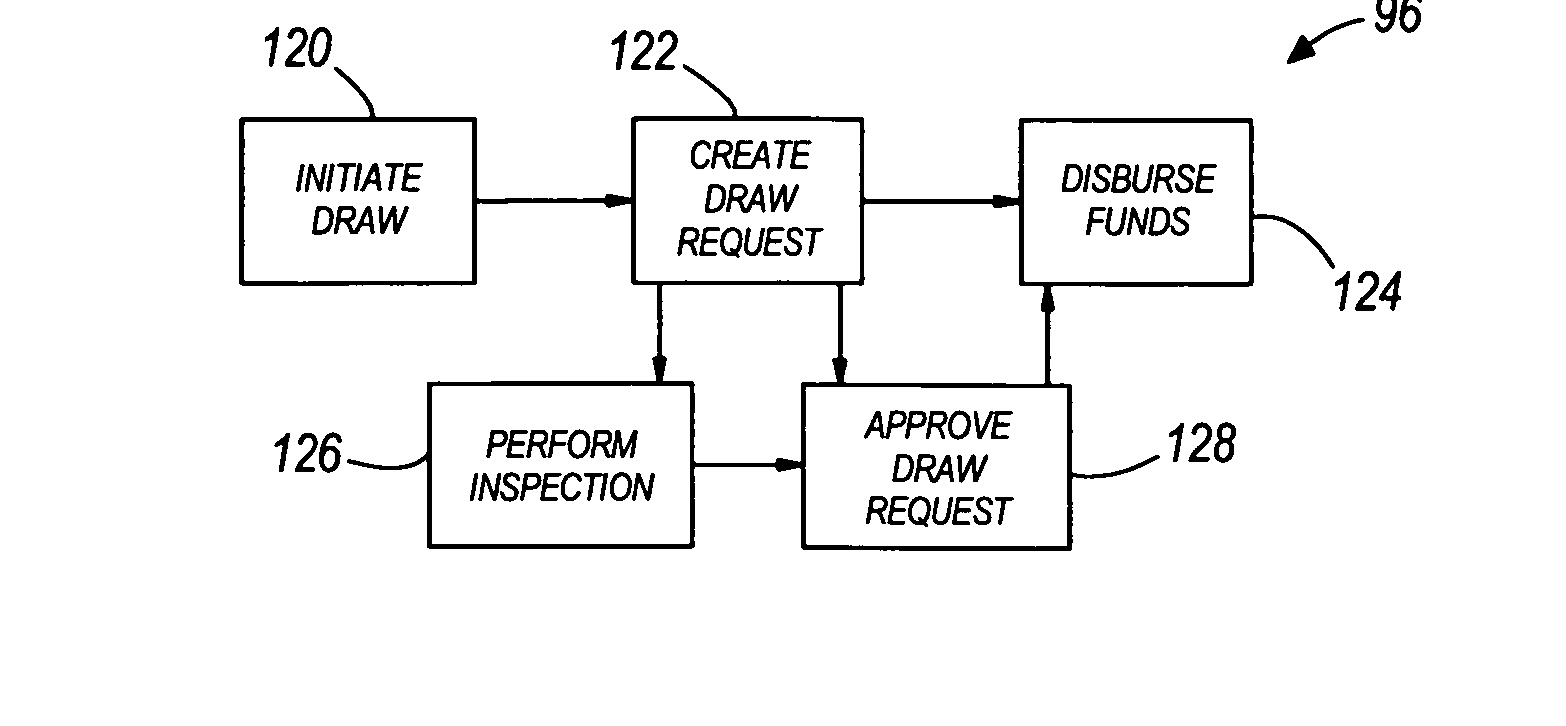

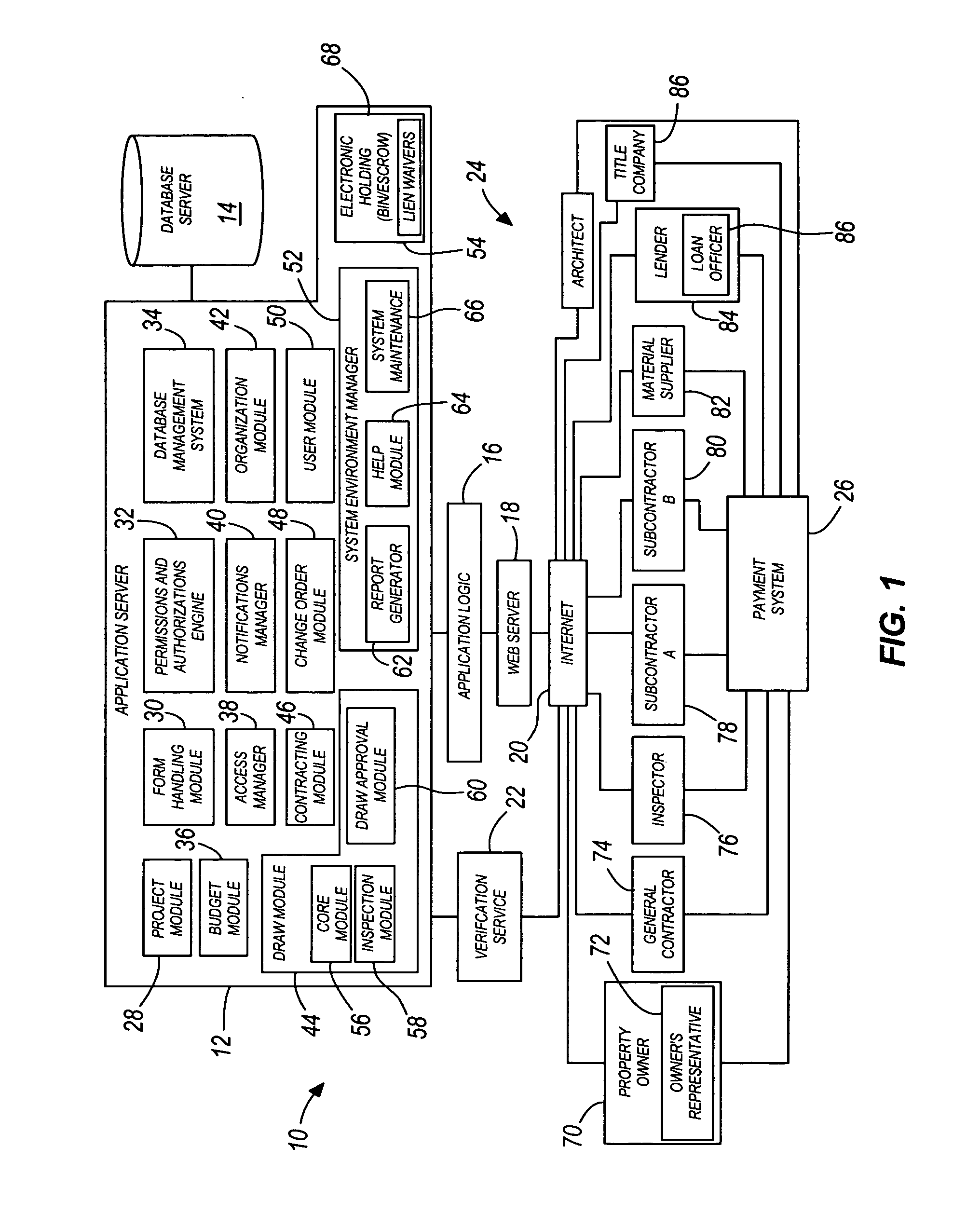

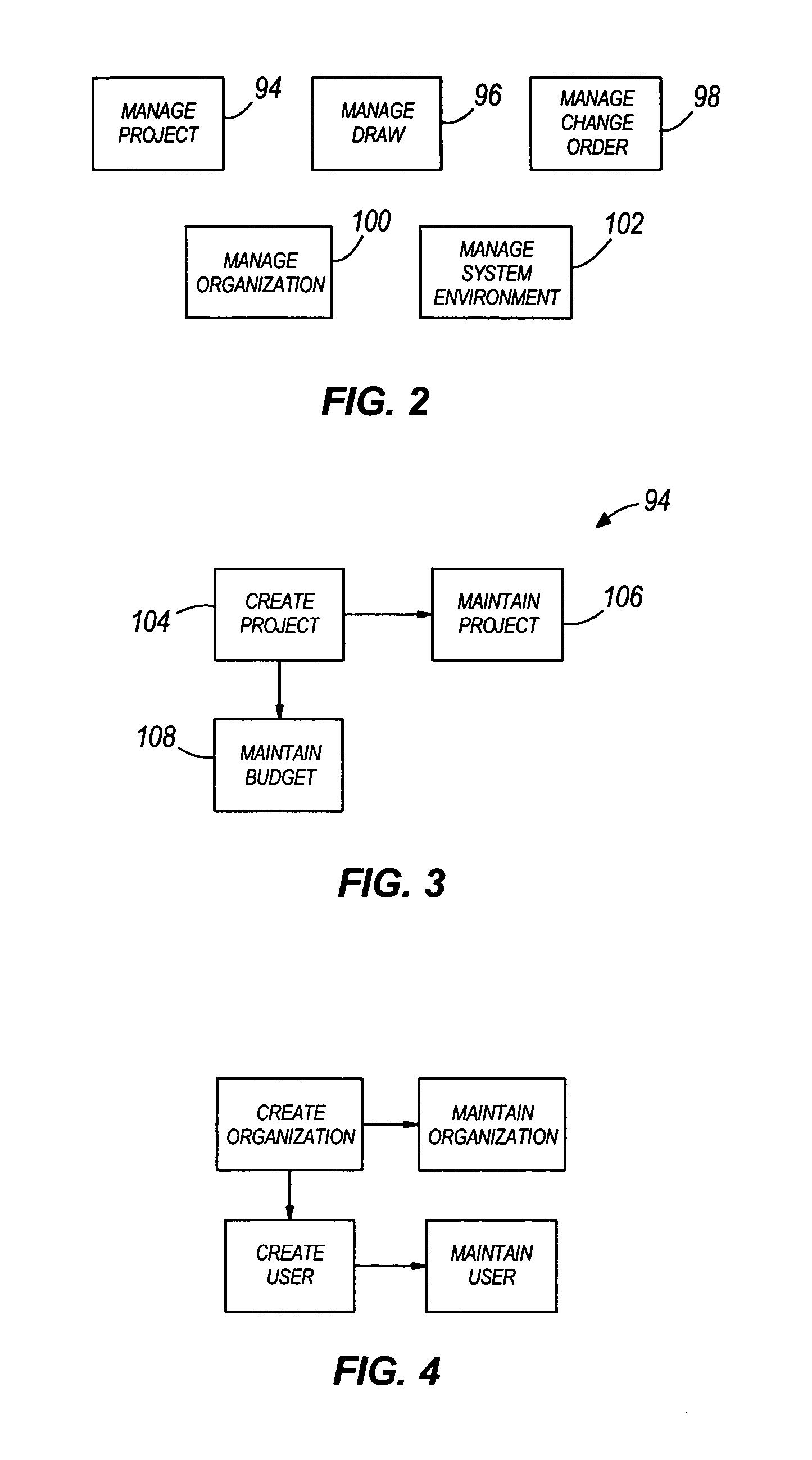

Construction payment management system and method with hierarchical invoicing and direct payment features

A system and method for managing a construction payment process. One method embodying the invention can include creating an electronically-executed first request for payment on behalf of a first participant in a construction project, transmitting the first request for payment to a second participant in the construction project, creating an electronically-executed second request for payment based on the first request for payment, transmitting the second request for payment to a payment source in the construction project, directing transmitting a payment to the second participant from the payment source, and directly transmitting a payment to the first participant from the payment source.

Owner:TEXTURA CORP

Loyalty rewards direct payment and incentive method and system

InactiveUS20130151325A1Reduces tender process timeReduces of rewardMarketingDirect PaymentsComputer science

A method and system of facilitating and expediting a Transaction between a Merchant and a Patron of the Merchant is provided. In one embodiment of the invention, a Patron who has previously registered their loyalty account to receive Incentive Rewards for completing the Transaction and to allow the transfer of funds, utilizing an ACH Transaction, from their account to the Merchant's account, can use a single Personal Loyalty Device to expedite, pay for and complete the Transaction and receive Incentive Rewards. According to the invention, after receiving the loyalty account number and, optionally Authentication Information, the Merchant transmits that information and, optionally, Transaction information, to a Rewards Transaction Server who verifies the Transaction, determines Incentive Rewards, generates an Accept Code and sends it to the Merchant, whereupon the Transaction is completed. The Rewards Transaction Server also causes one or more ACH transactions to occur to transfer the funds.

Owner:POIDOMANI MARK +1

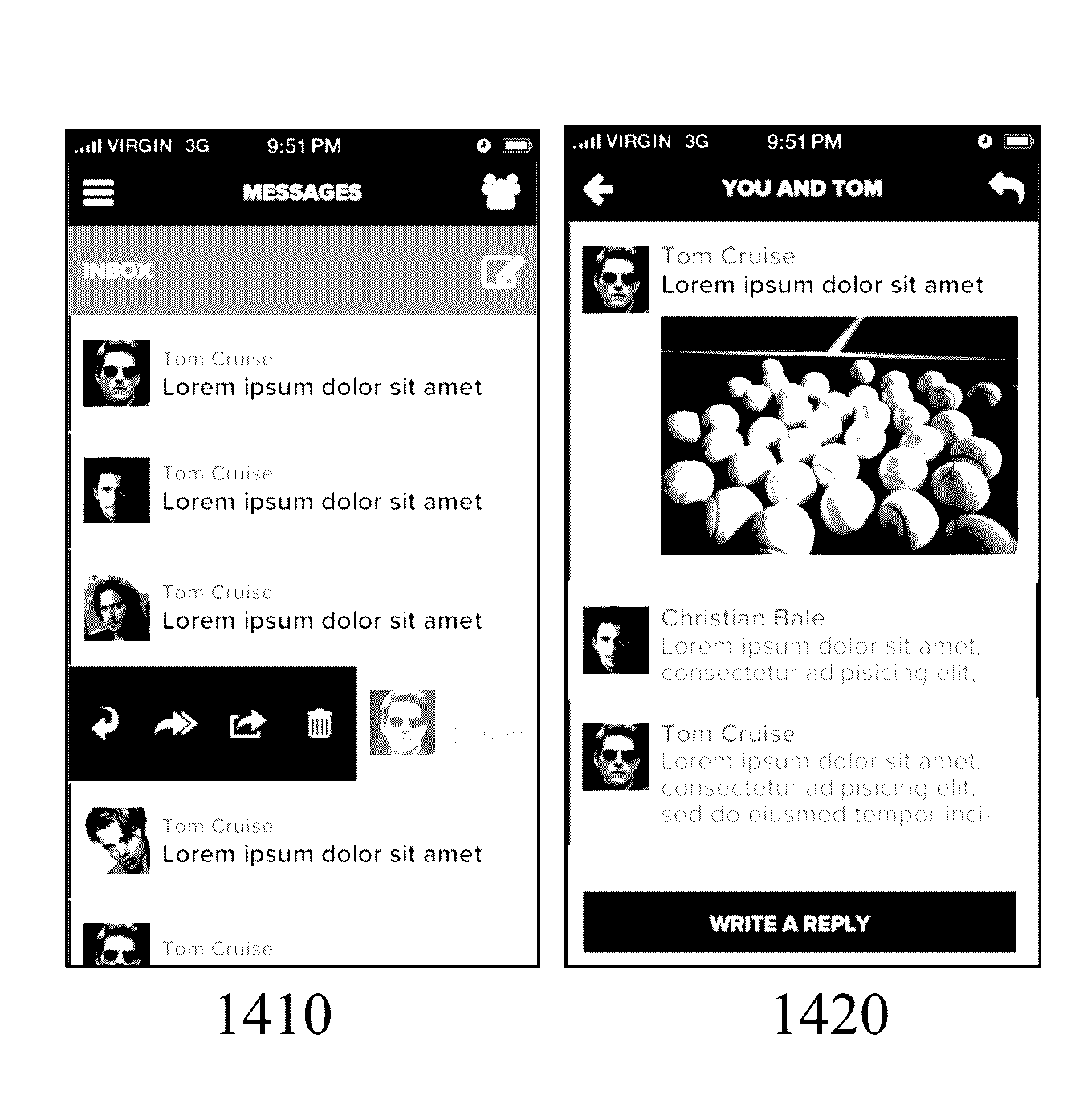

Methods and systems relating to auto-generated private communities

ActiveUS20170024832A1Improve satisfactionMultimedia data browsing/visualisationCryptography processingVisibilitySkill sets

Establishing online social communications for enterprises whilst beneficial to them in terms of revenue, customer retention etc. require skills and time, both of which the enterprises personnel do not possess. The inventors have established an inventive turn-key software application that allows an enterprise to create invitation only private groups on mobile device platforms and monetize aspects of this online private group through direct payments to the club owner. An individual, a group, a society, a business or enterprise irrespective of whether they are active on other social networks can exploit the inventive turn-key software application augmenting their business with clear visibility of the return on investment. As such the inventive turn-key software application provides an effective “one-stop shop” for those looking to establish and build their brand on mobile technology.

Owner:MOBILITHINK SOLUTIONS

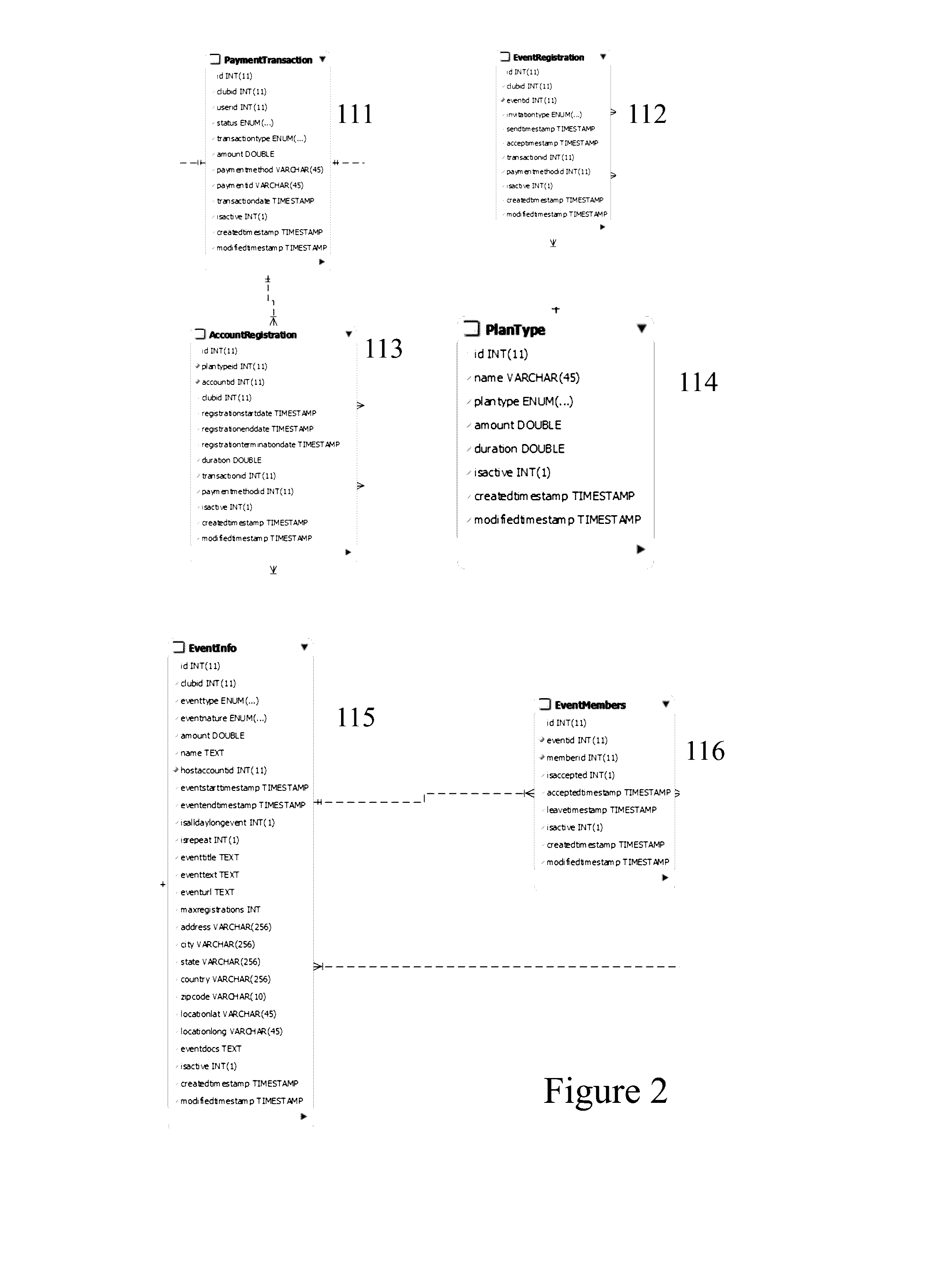

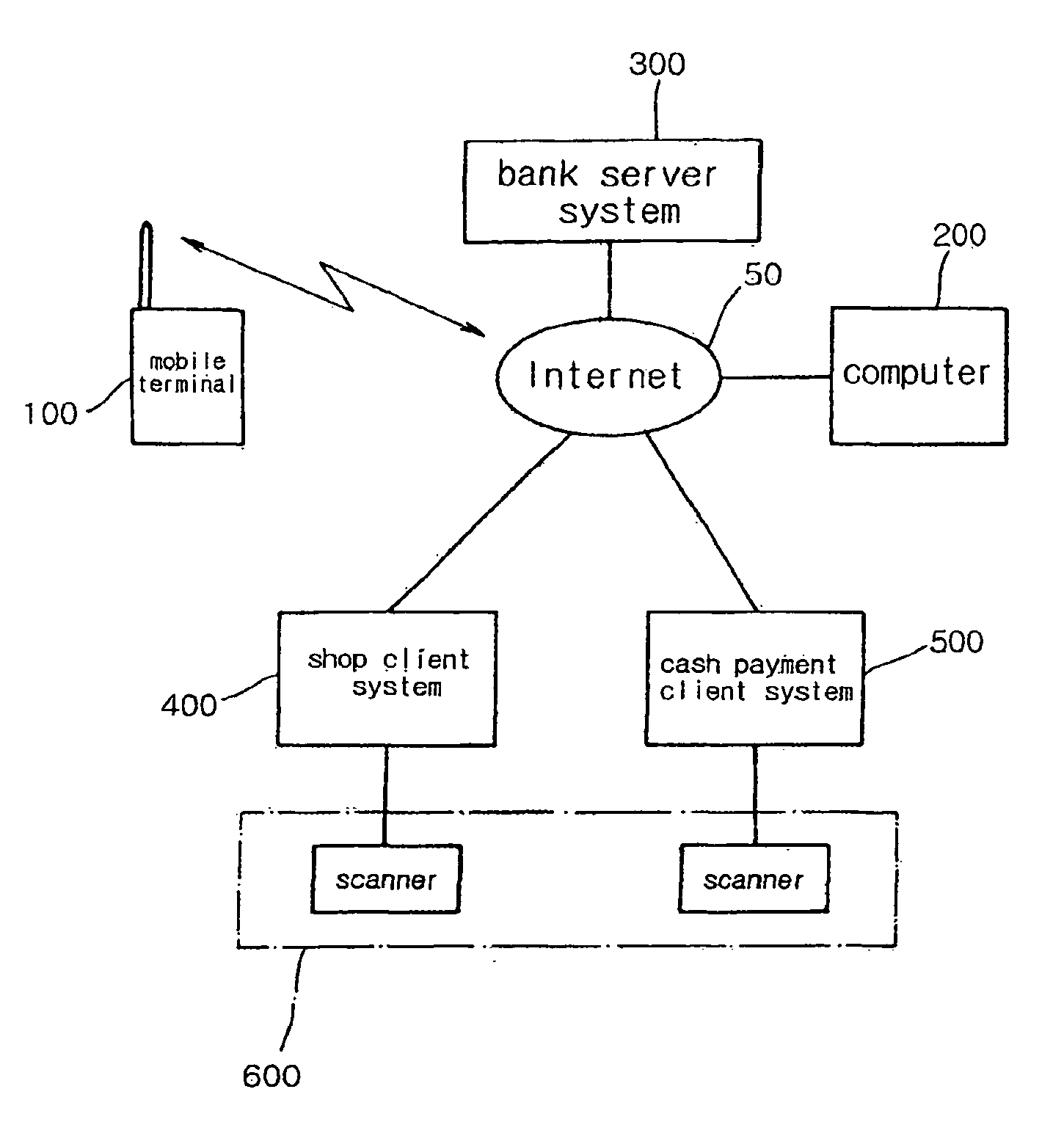

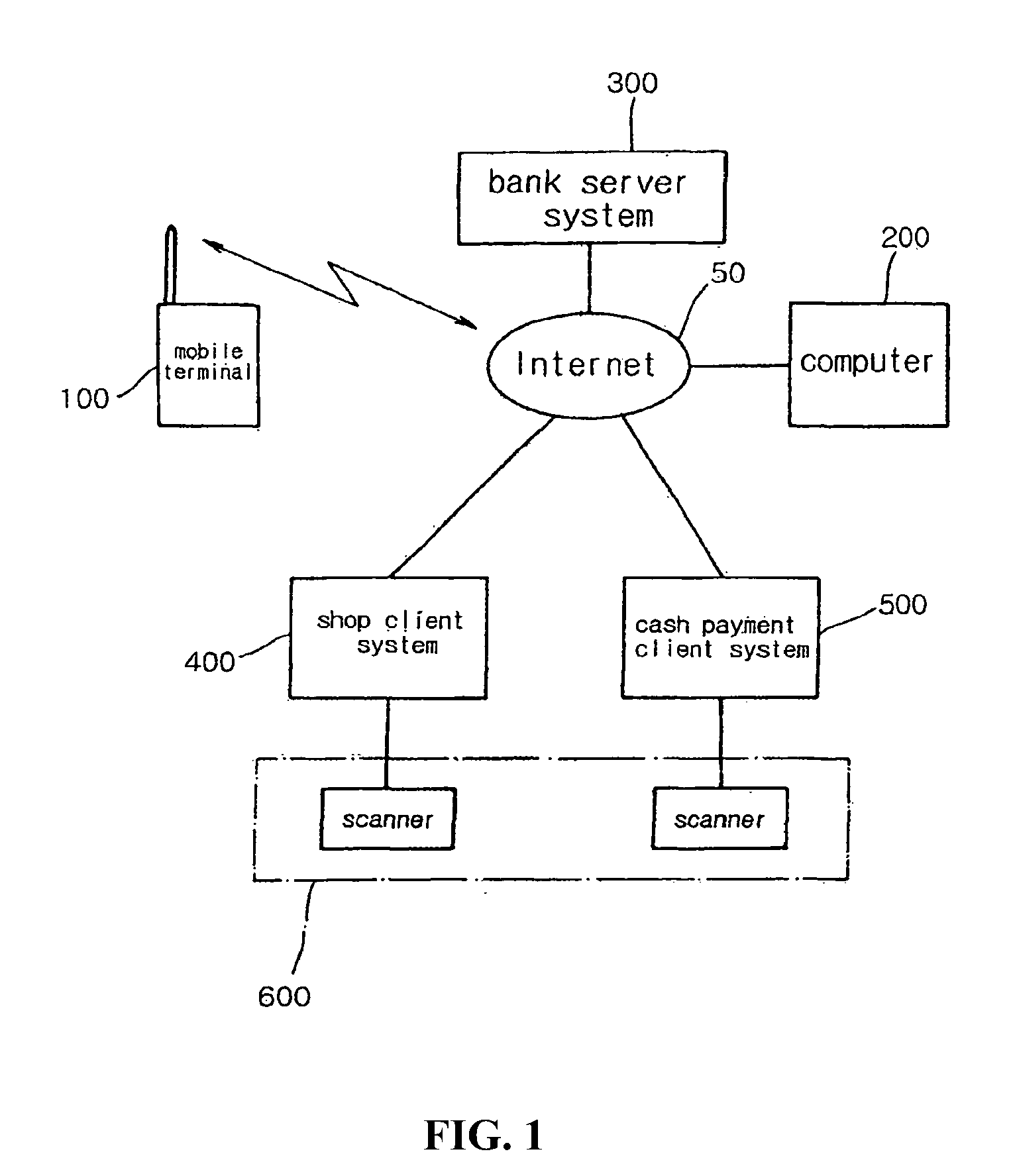

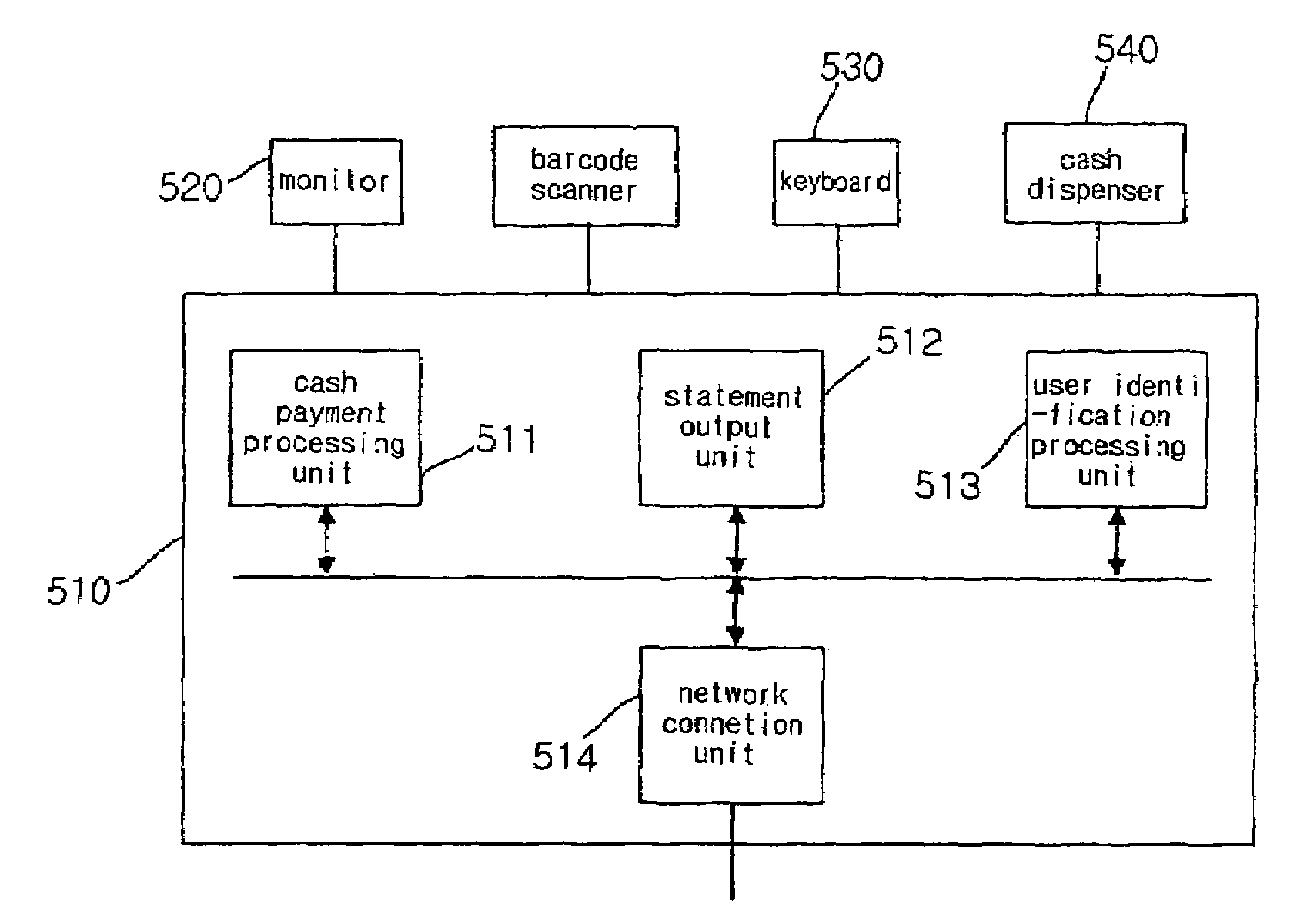

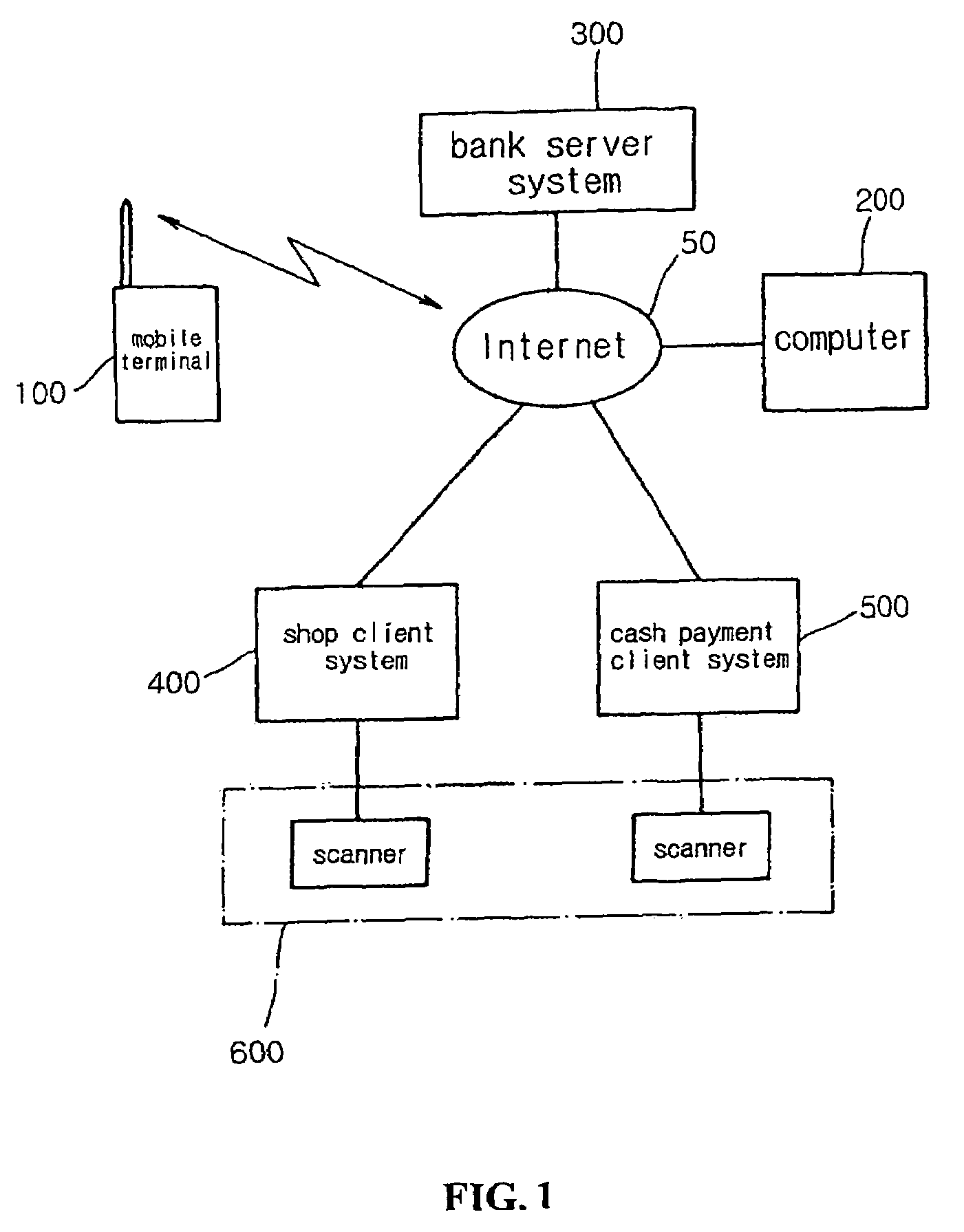

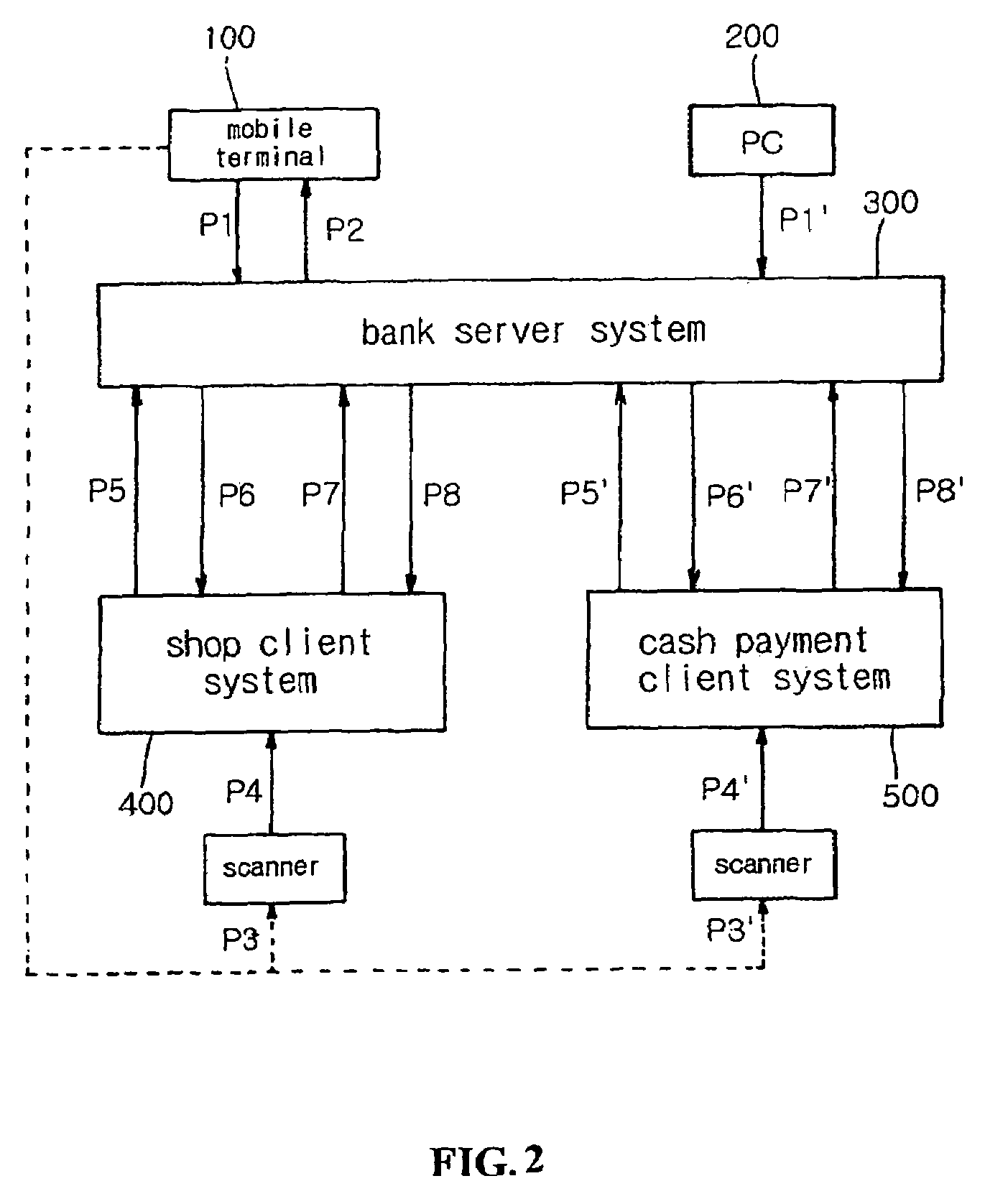

Electronic settlement system, electronic settlement method and cash paying method using LCD barcode displayed on mobile terminal

Owner:PANTECH CO LTD

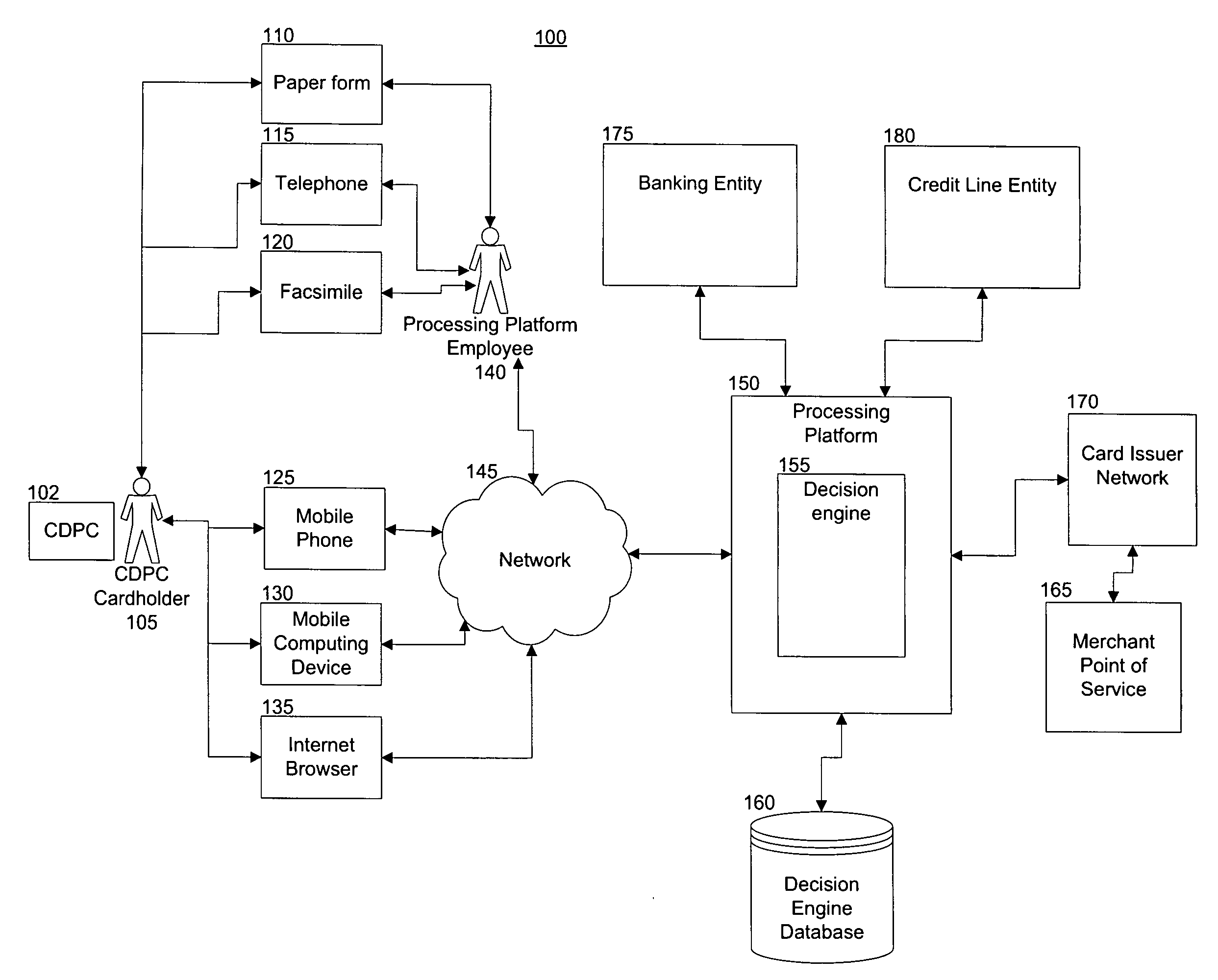

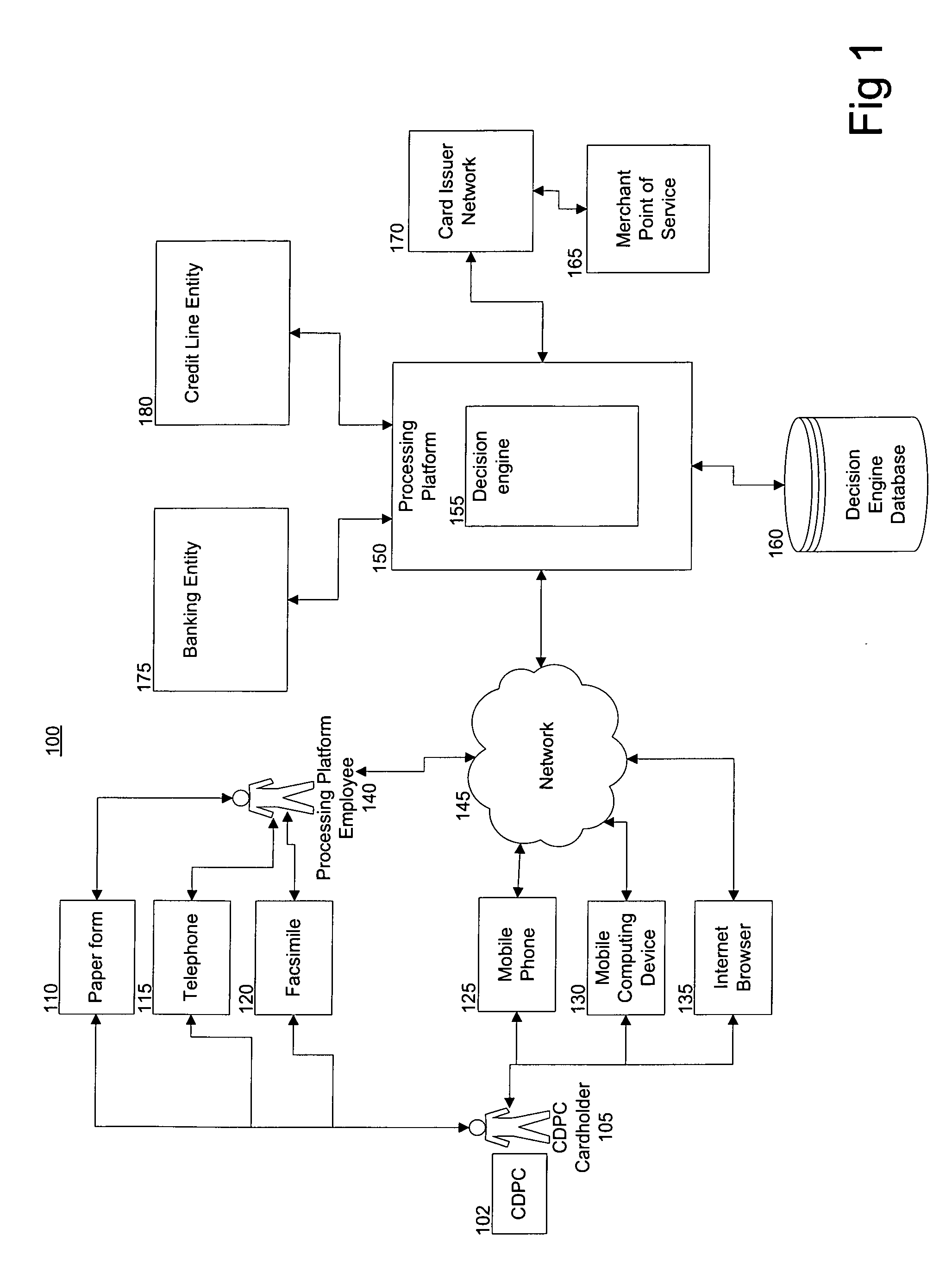

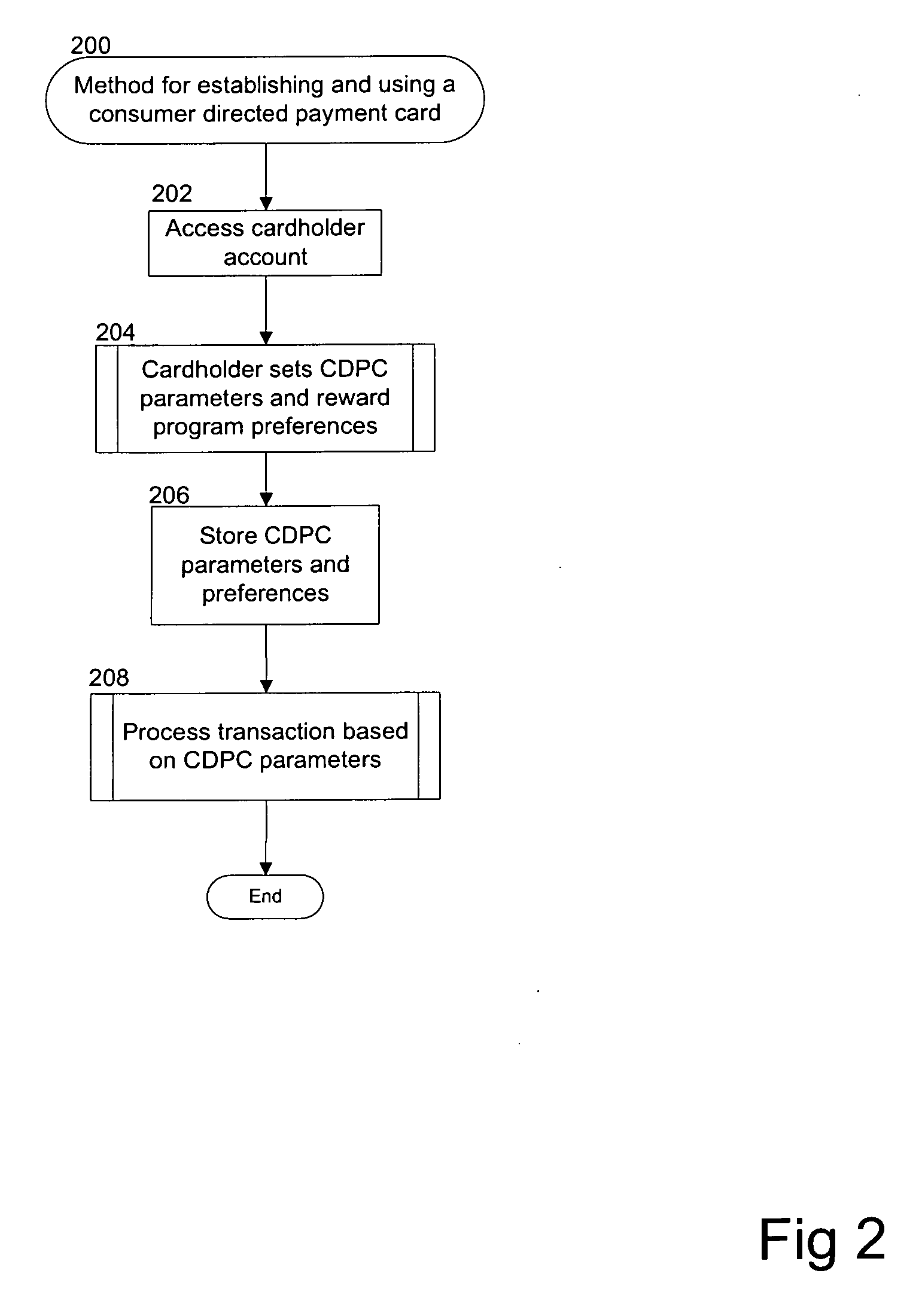

System and method for providing consumer directed payment card

InactiveUS20090216638A1Larger share of the profitsReduce in quantityDiscounts/incentivesFinancePayment transactionTransaction data

Providing a consumer directed payment card (“CDPC”). Parameters for the CDPC are established in advance of the processing of a transaction to define how transactions are to be processed. The parameters are based on attributes of the transaction, such as transaction value, fund availability, credit availability, merchant type, merchant location, and date. The transaction processes include debit, credit, stored value, installment loan, and other deferred-payment transaction types. Parameters are stored and accessed during a transaction. The appropriate transaction process is determined based on the parameters, and the transaction is processed. A processing platform can be logically connected to a network, banking entity, credit line entity, and a network. The processing platform includes a decision engine, which is logically connected to a decision engine database. The decision engine compares the transaction data to the parameters, and communicates the appropriate transaction process to the processing platform for processing.

Owner:TOTAL SYST SERVICES

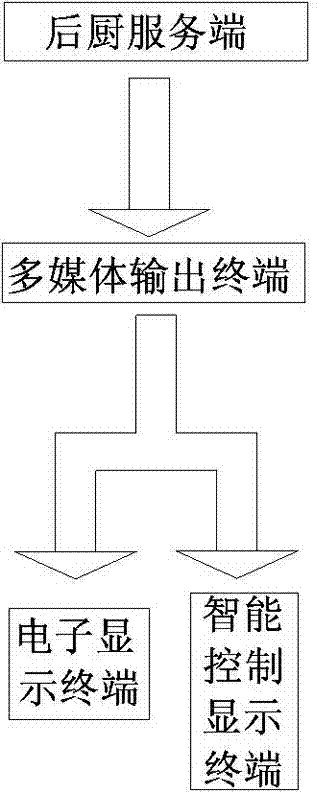

Intelligent self-service restaurant management system

InactiveCN103927623AReduce usageReduce dependenceCo-operative working arrangementsResourcesComputer networkWaiters/waitresses

The invention discloses an intelligent self-service restaurant management system. According to the intelligent self-service restaurant management system, the currently-fashionable graphic code scanning technology such as two-dimension codes is used, graphic codes which can provide dining table position numbers and electronic menus for follow-up service terminals are arranged on dining tables, consumers can obtain the electronic menus by scanning the graphic codes on the dining tables through mobile terminals such as mobile phones, can complete menu browsing and order placing, and can select payment modes such as the mobile phone payment mode, the direct payment mode and an after-meal payment mode, and after the payment modes are selected, the bar counter service terminal and the kitchen service terminal can be reminded of order information through a server to carry out corresponding processing. In this way, the number of employed waiters is greatly decreased, intelligence of the whole processes of menu obtaining, food selecting, order payment, order placing and kitchen order processing is achieved, the operating cost of a catering enterprise is reduced, the dependency on the larger number of employed waiters is reduced, and unpleasant events caused by service levels and service attitudes of the waiters and generated between the waiters and the consumers are reduced.

Owner:HENAN ZHIYE TECH DEV +2

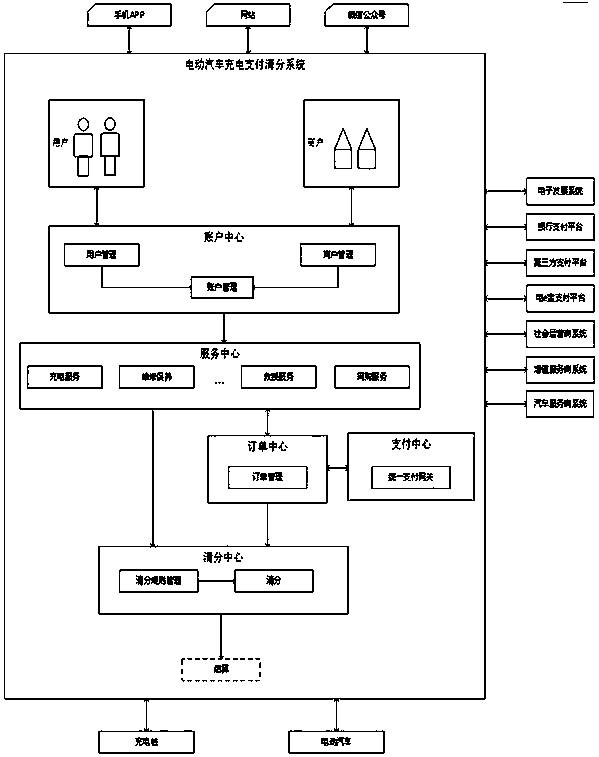

Electric automobile payment sorting system based on micro-services

InactiveCN108520405AEasy accessAvoid situations where you can't chargePayment protocolsService domainDirect Payments

The invention belongs to the field of automobile networking service, and particularly relates to an electric automobile payment sorting system based on micro-services. The system comprises an accountcenter micro-service, a service center micro-service, an order center micro-service, a payment center micro-service and a sorting center micro-service; the account center micro-service mainly comprises a user management module, a merchant management module and an account management module, the service center micro-service comprises a charging service module, a maintenance module, a rescue servicemodule, an online shopping service module and the like, the order center micro-service provides service for generating orders and order management, the payment center micro-service provides two modesof direct payment to the commercial tenants and the platform collecting for different commercial tenants to choose, and the sorting center micro-service is changed according to different sorting requirements, and meanwhile, performs the adaptive model matching on the sorting rule and division proportion. According to the invention, the payment and sorting strategies can be customized for the commercial tenants to match the marketing strategies of various commercial tenants conveniently, and the system has wide applicability.

Owner:BEIJING KEDONG ELECTRIC POWER CONTROL SYST

Electronic settlement system, electronic settlement method and cash paying method using LCD barcode displayed on mobile terminal

Disclosed are an electronic settlement system, an electronic settlement method, and a cash payment method using a LCD barcode displayed on a mobile terminal, thereby simply performing member identification using the LCD barcode including member information, electronic settlement services (such as credit card settlement, direct payment card settlement, advance payment card settlement, small amount settlement, and Giro system settlement) at various shops via a procedure verifying whether a user is an actual owner of the barcode, cash payment services via member information barcode and member identification procedures, advance payment card services by depositing a designated amount of money at a database of the bank and allowing the user to systematically use the advance card within the deposited money, and wireless banking services for transmitting and receiving various banking related data via wireless network between the bank and the members.

Owner:SECUBAY CORP +1

Buyer initiated payment

InactiveUS20140344156A1FinanceBuying/selling/leasing transactionsDeposit accountFinancial transaction

Owner:HILT NATHAN JOHN +2

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com