Patents

Literature

55 results about "Electronic bill payment" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

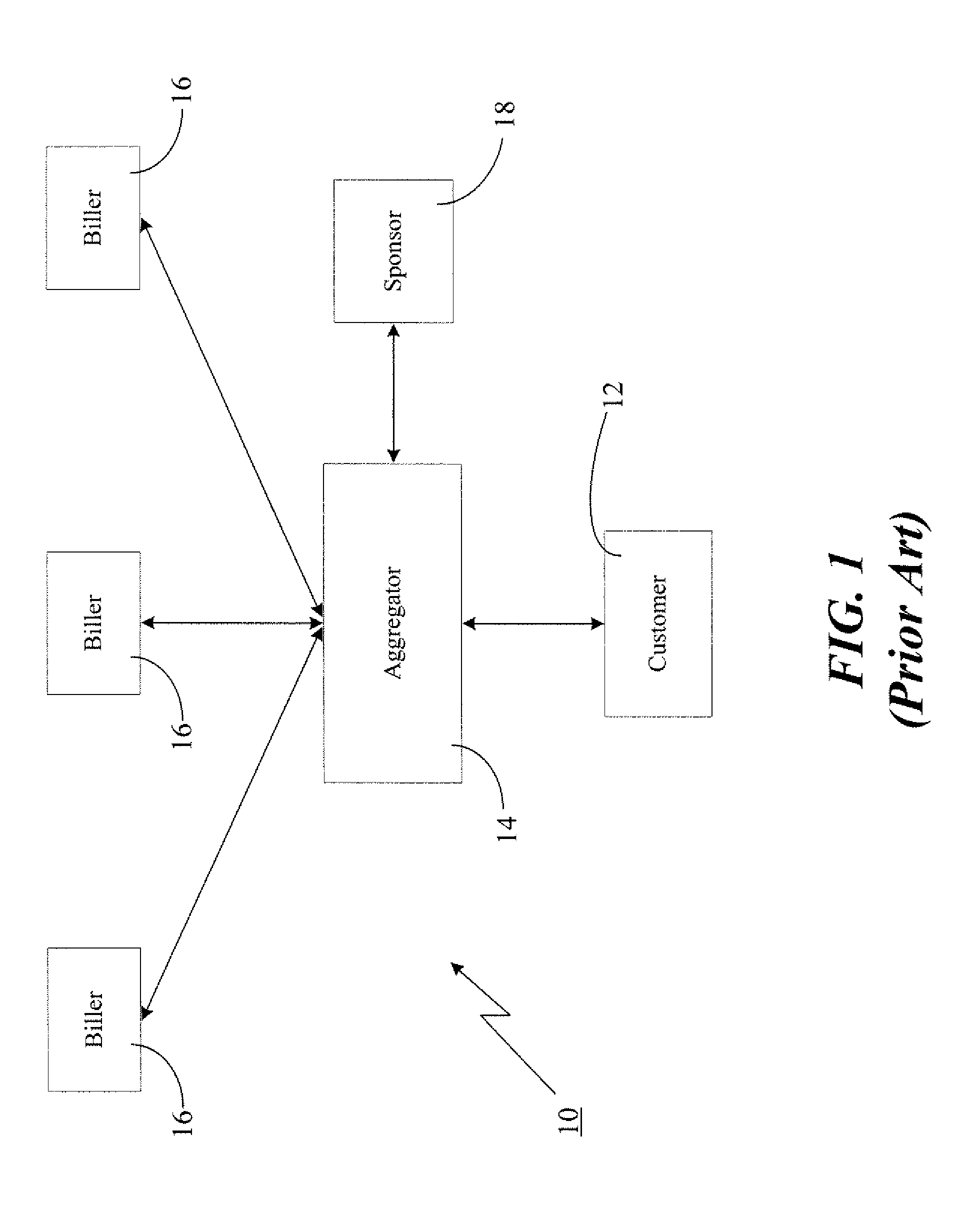

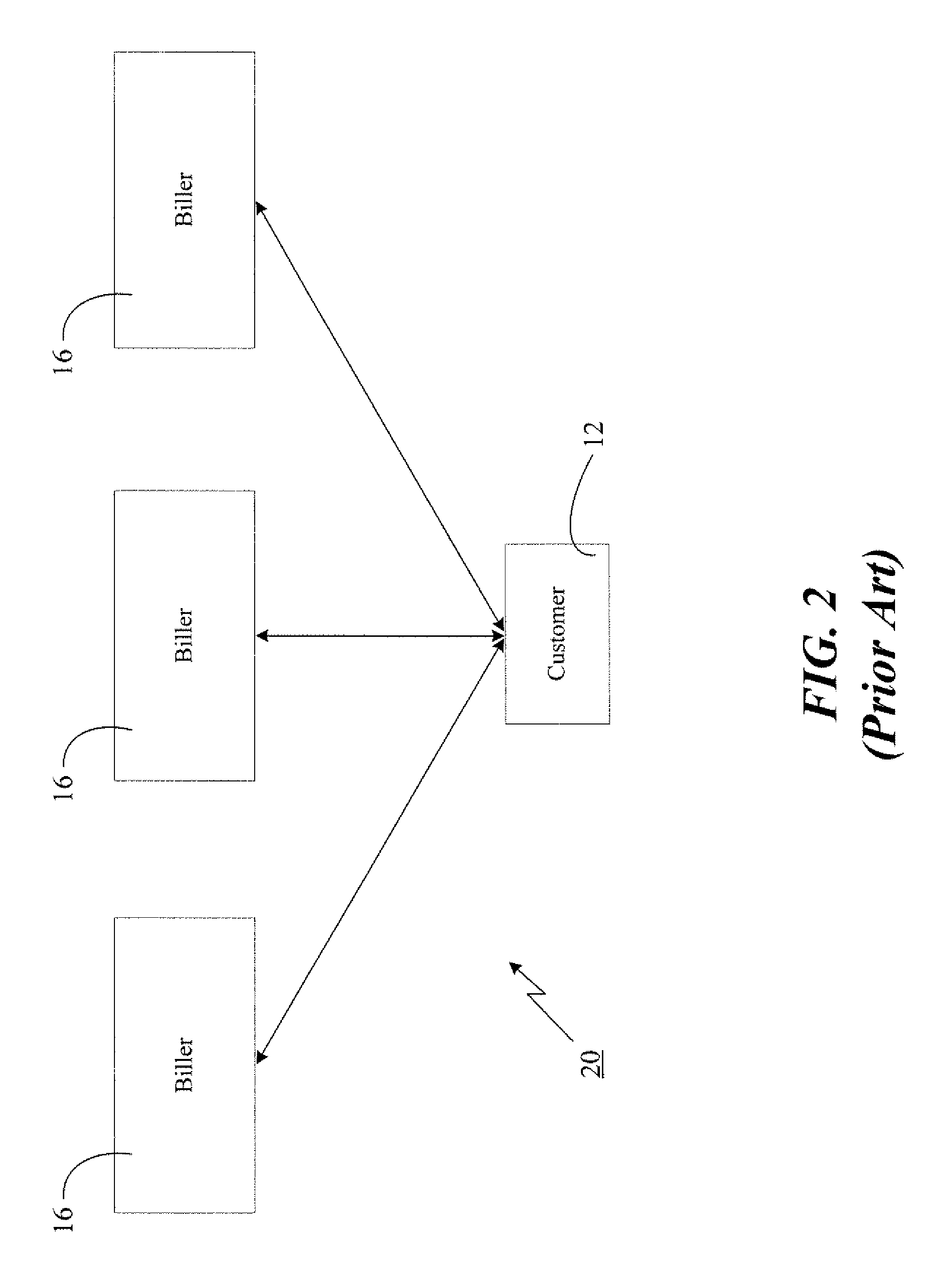

Electronic bill payment is a feature of online, mobile and telephone banking, similar in its effect to a giro, allowing a customer of a financial institution to transfer money from their transaction or credit card account to a creditor or vendor such as a public utility, department store or an individual to be credited against a specific account. These payments are typically executed electronically as a direct deposit through a national payment system, operated by the banks or in conjunction with the government. Payment is typically initiated by the payer but can also be set up as a direct debit.

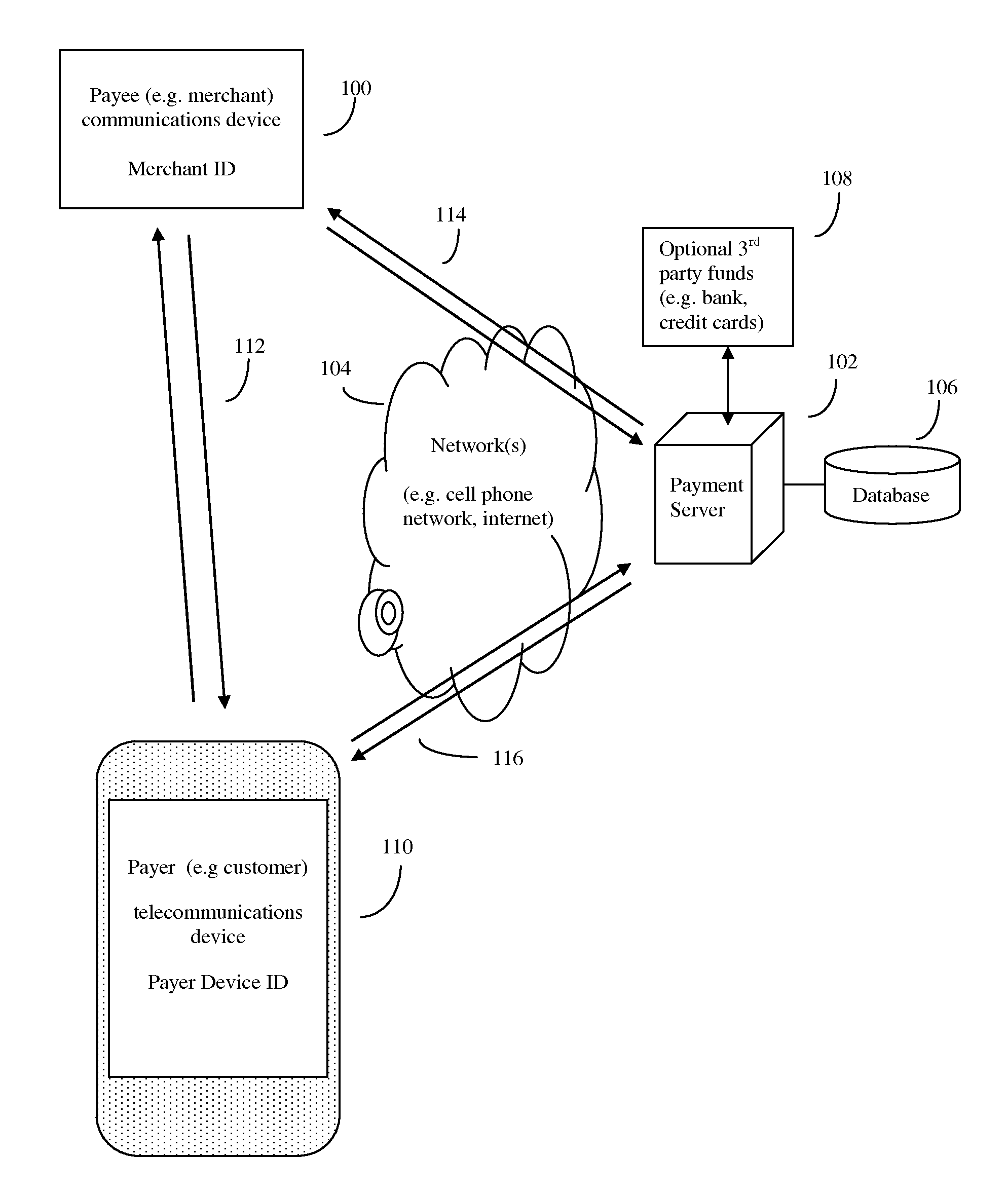

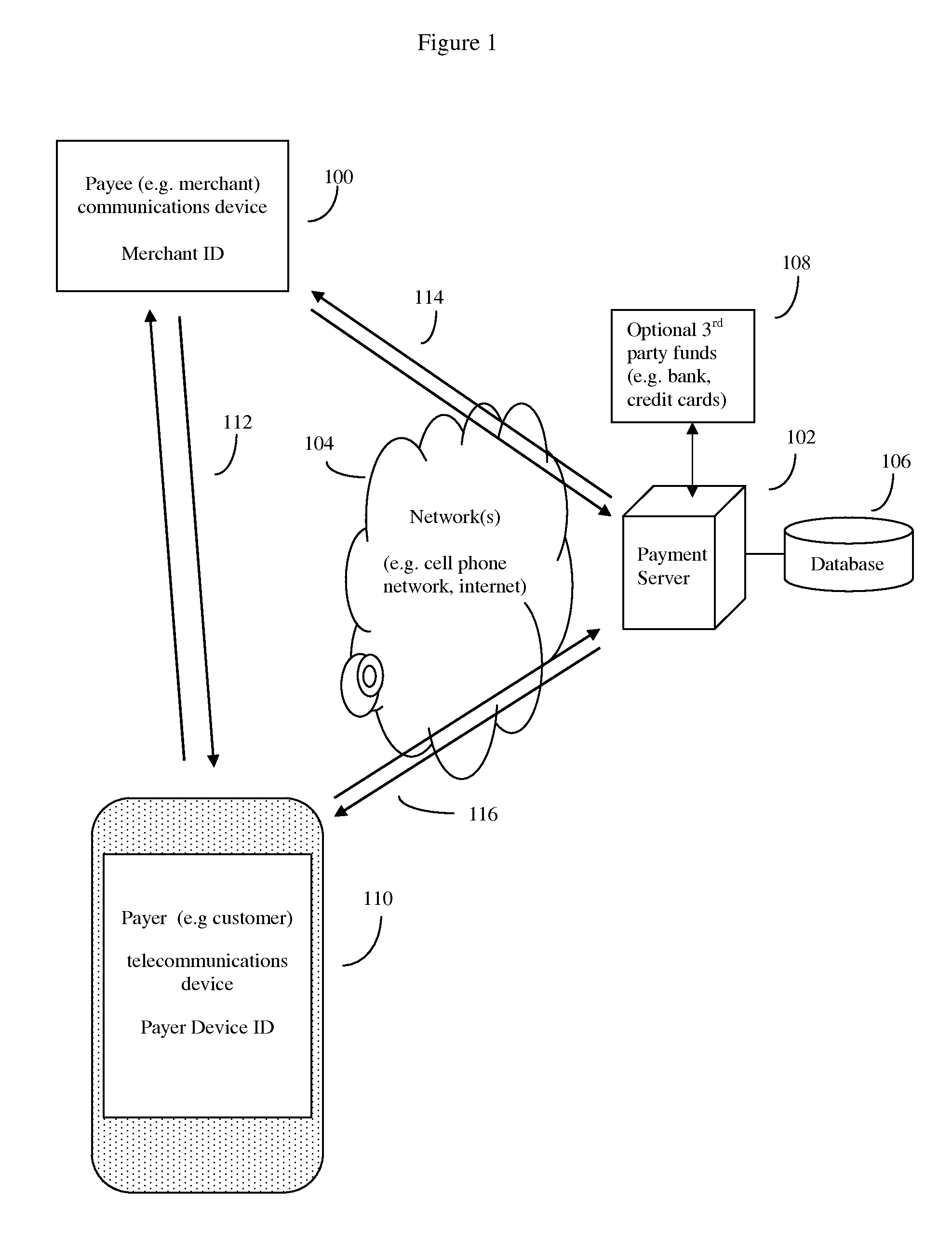

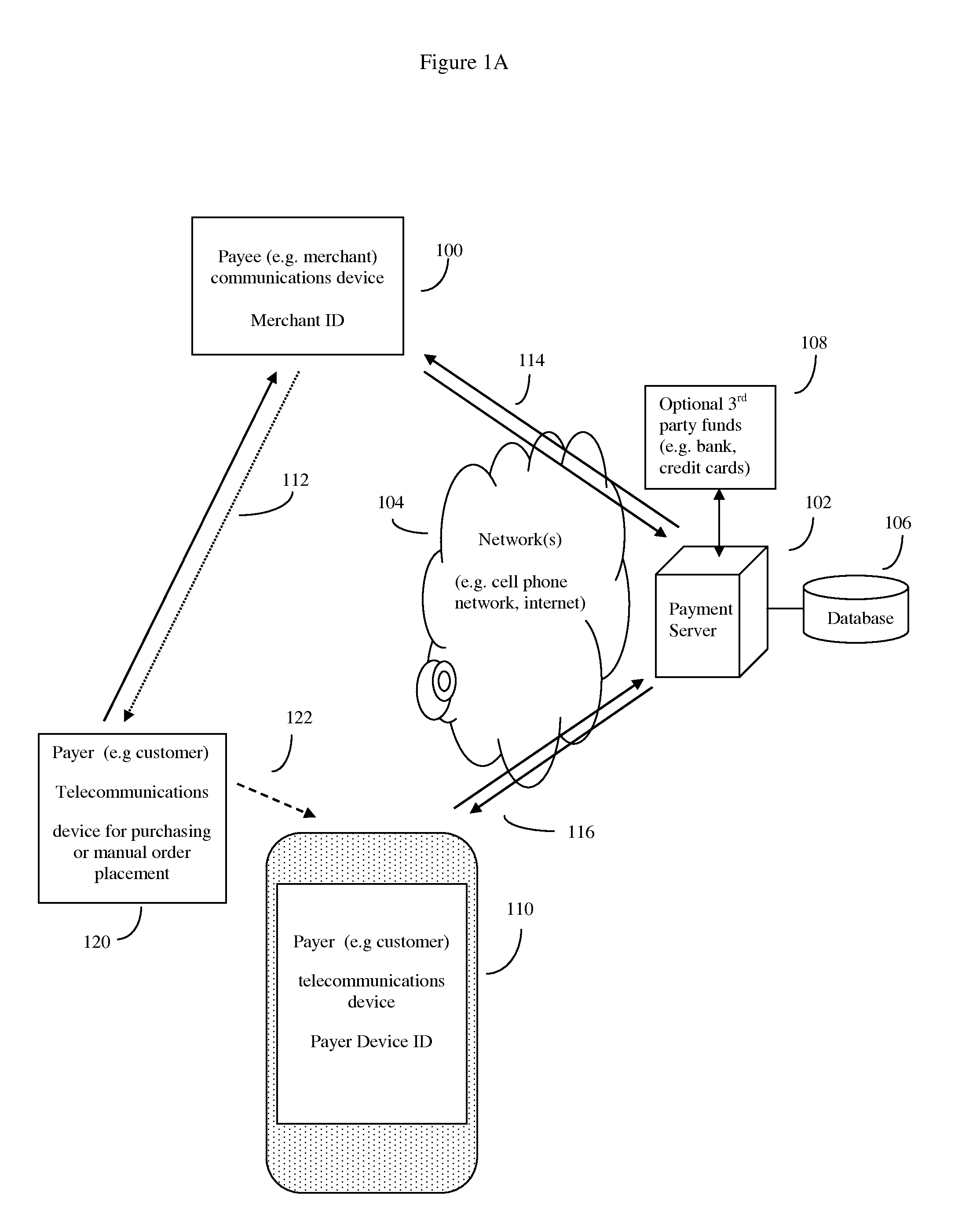

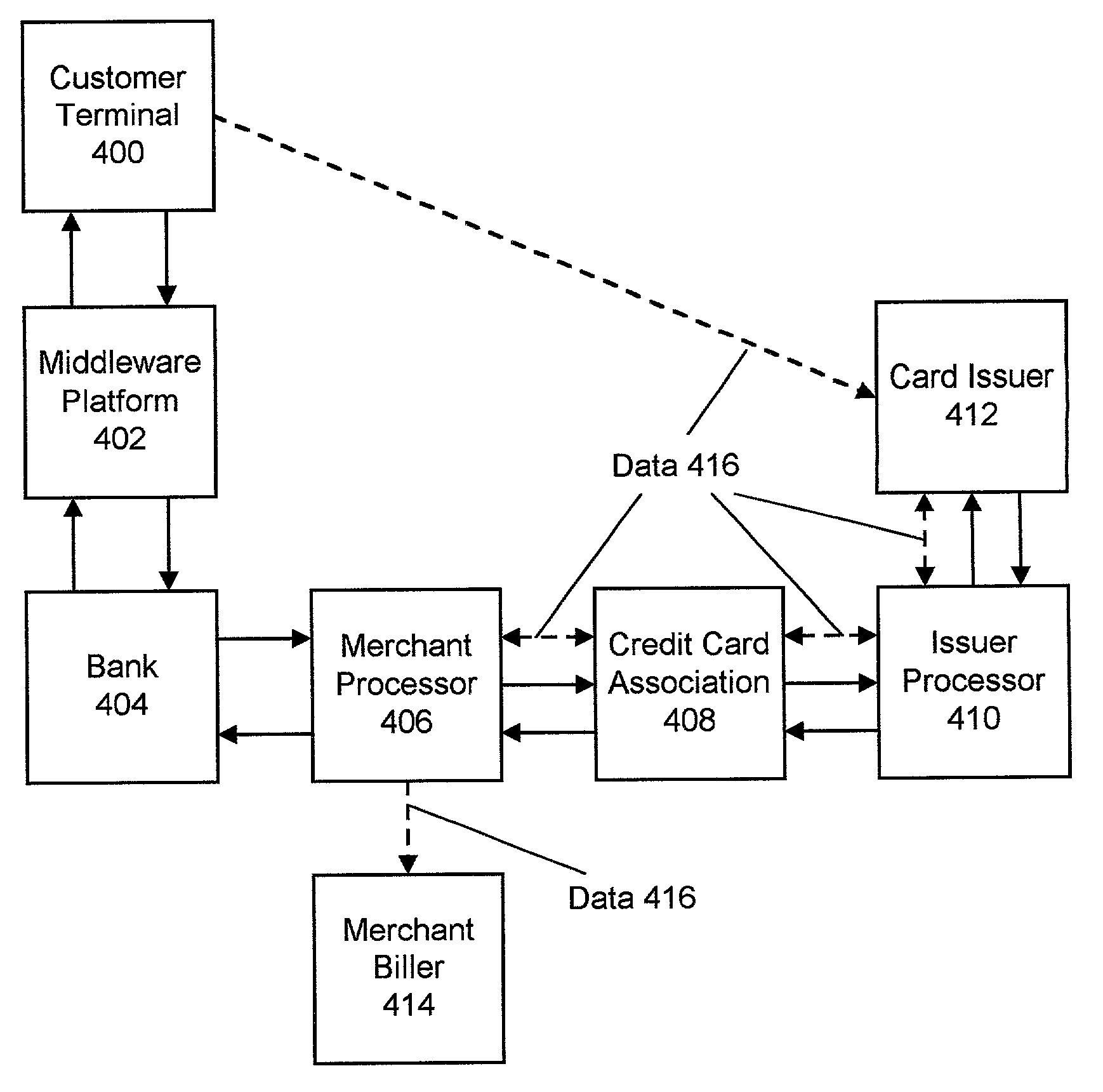

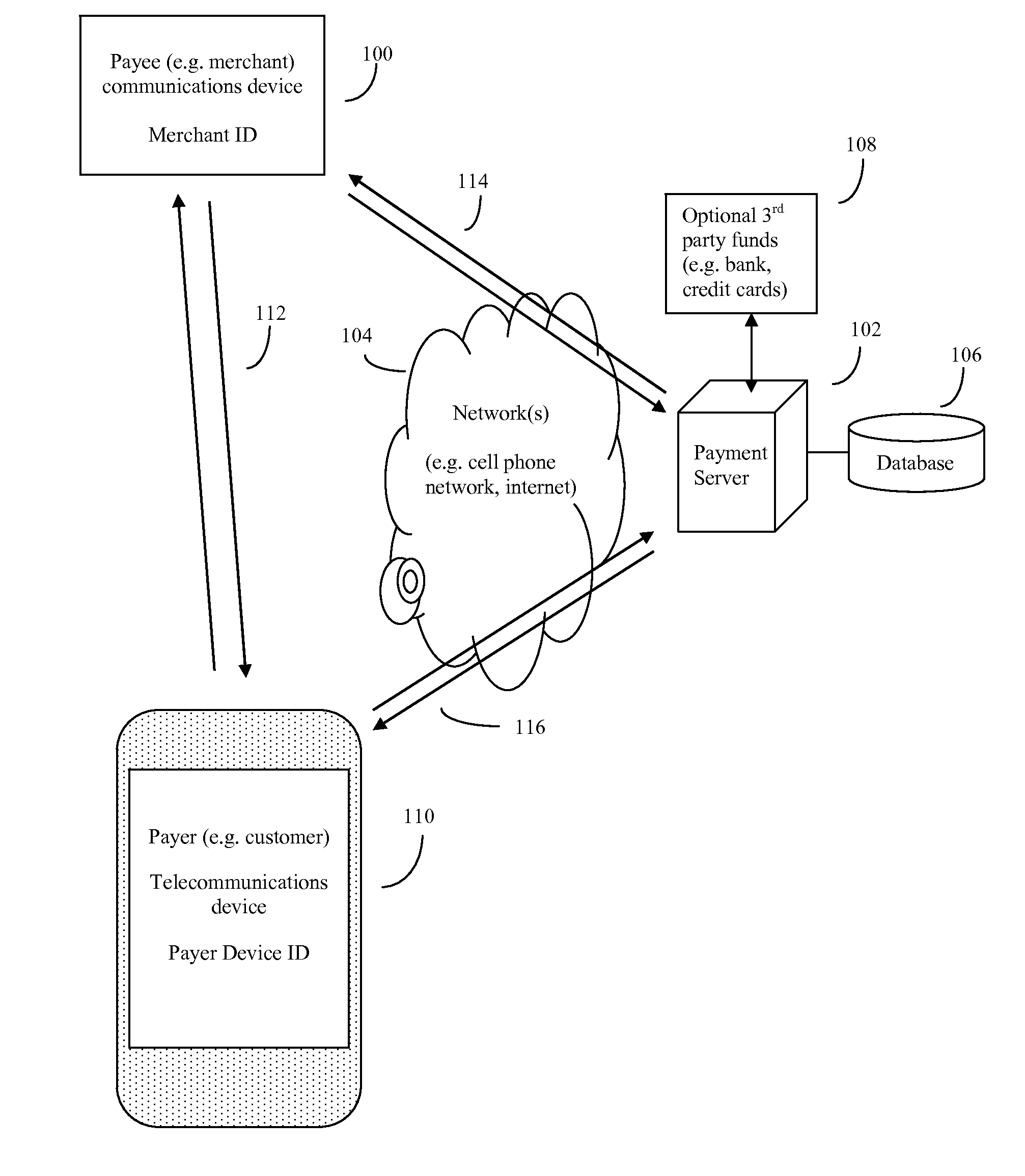

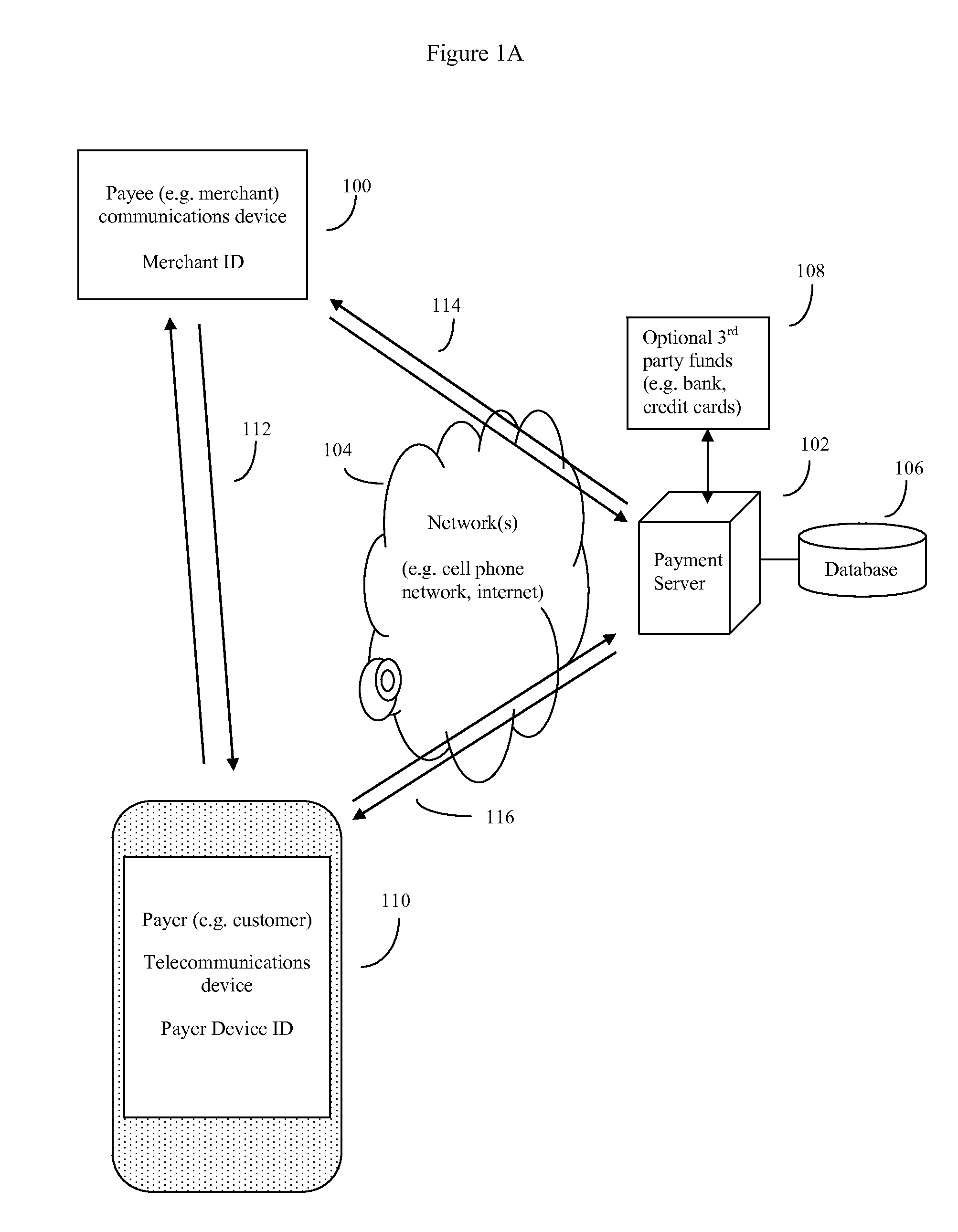

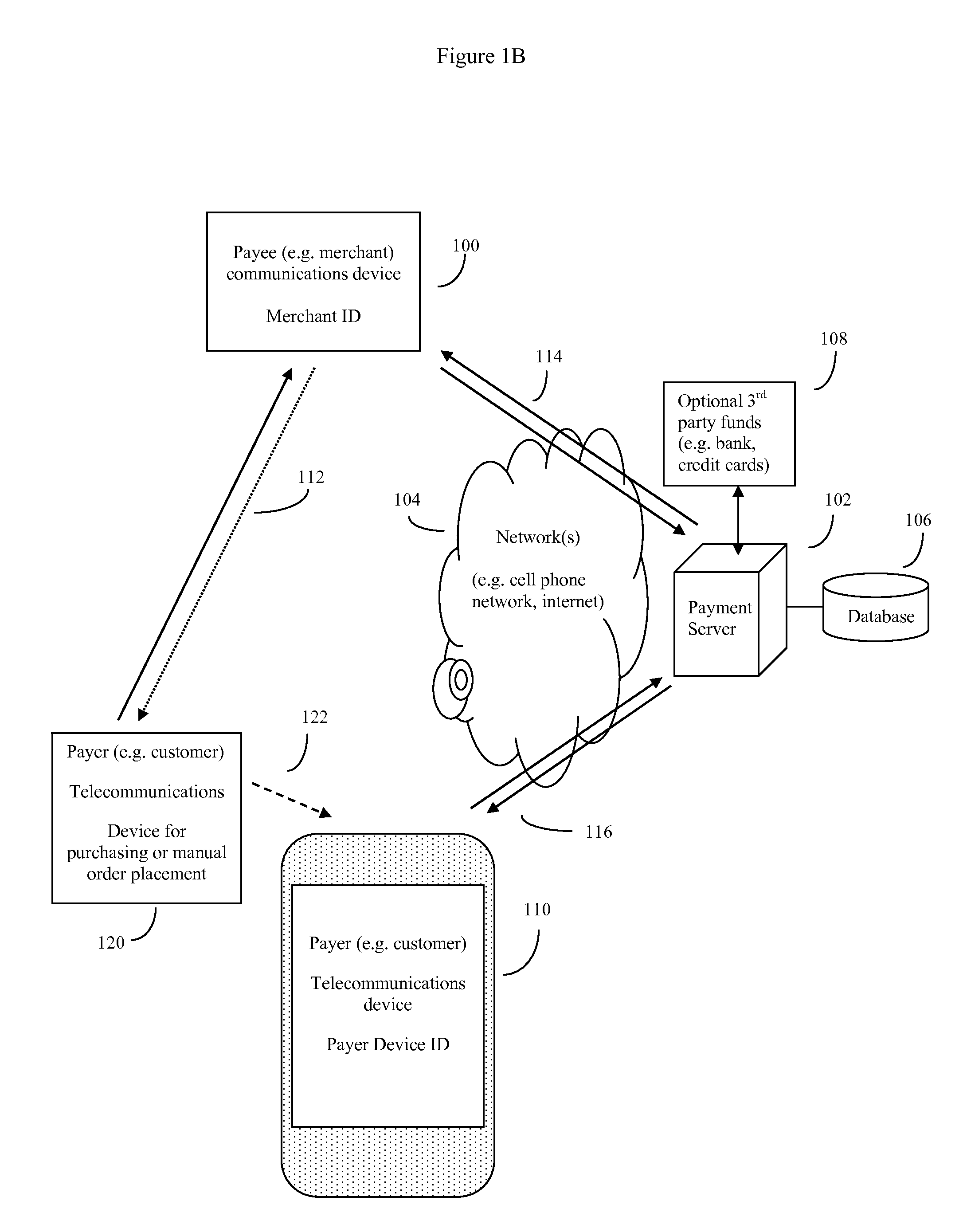

System and method of electronic payment using payee provided transaction identification codes

InactiveUS20130124364A1High degreeImprove conveniencePayment architectureBuying/selling/leasing transactionsPaymentFinancial transaction

A computerized method of payment based on short, temporary, transaction ID numbers which protect the security of the payer's (customer's) financial accounts. The payee will first register a source of funds and a payer device with a unique ID (such as a mobile phone and phone number) with the invention's payment server. Then once a payee (merchant) and the payer have agreed on a financial transaction amount, the payee requests a transaction ID from the payment server for that amount. The payment server sends the payee a transaction ID, which the payee then communicates to the payer. The payer in turn relays this transaction ID to the server, which validates the transaction using the payer device. The server then releases funds to the payee. The server can preserve all records for auditing purposes, but security is enhanced because the merchant never gets direct access to the customer's financial account information.

Owner:MITTAL MILLIND

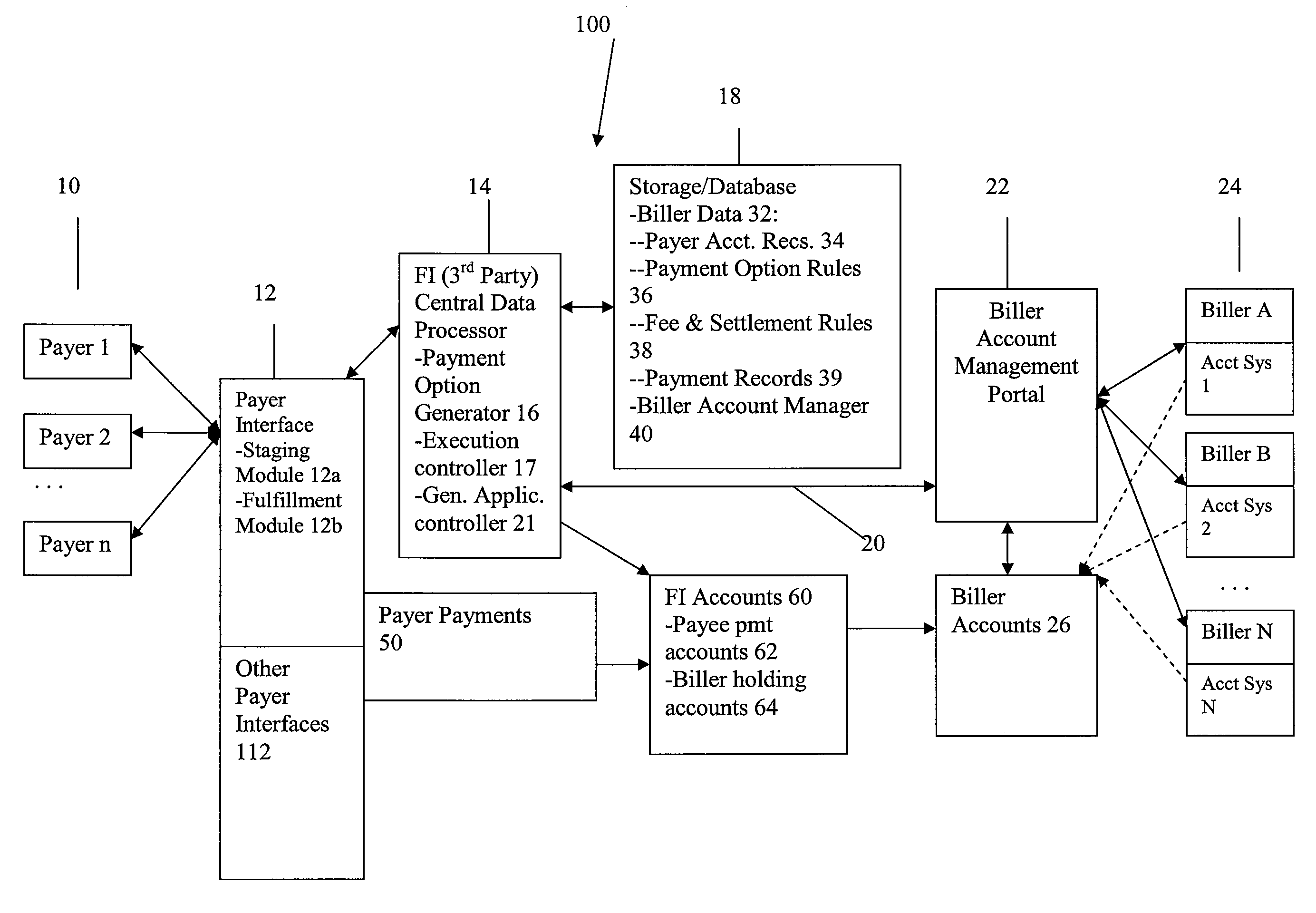

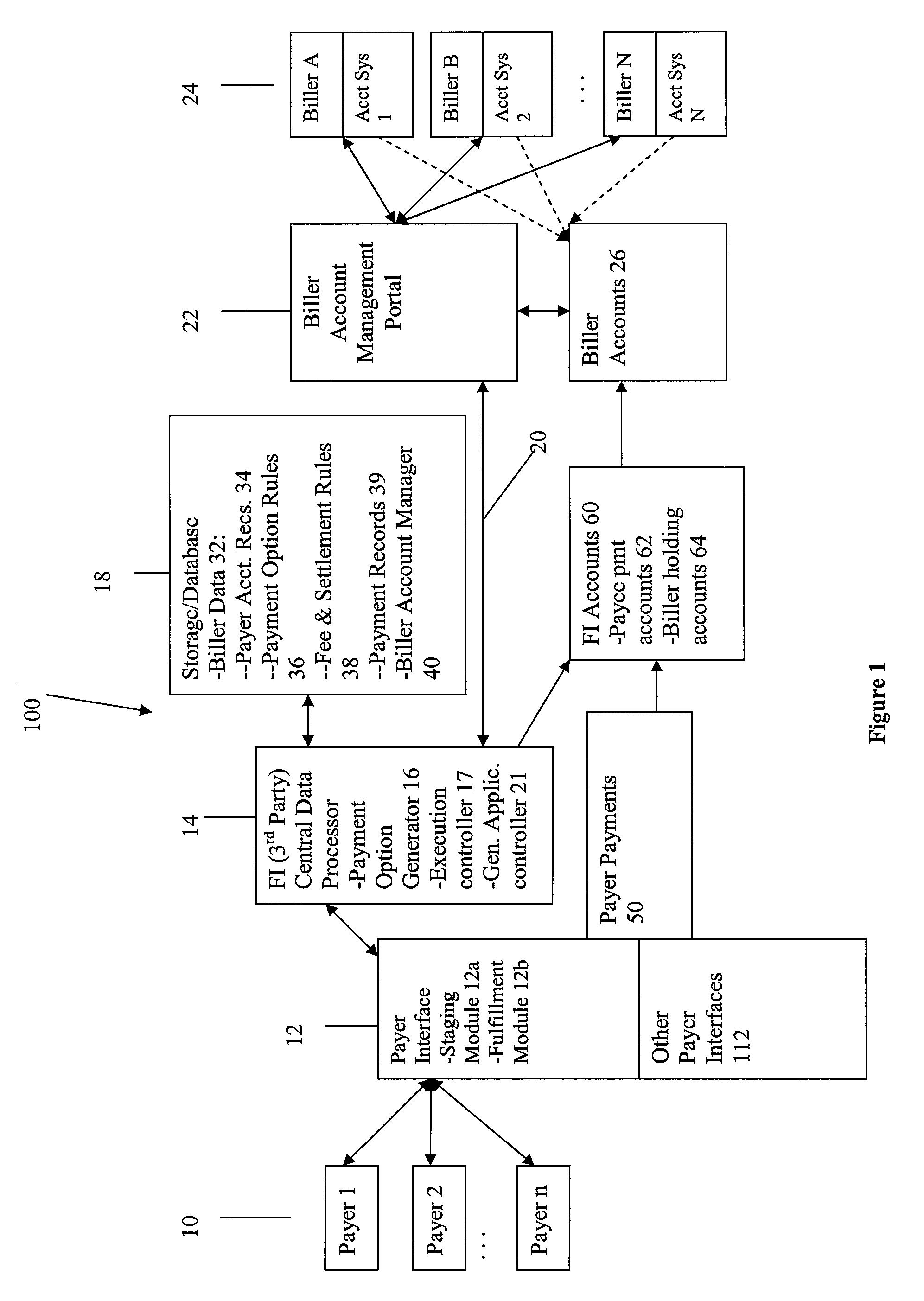

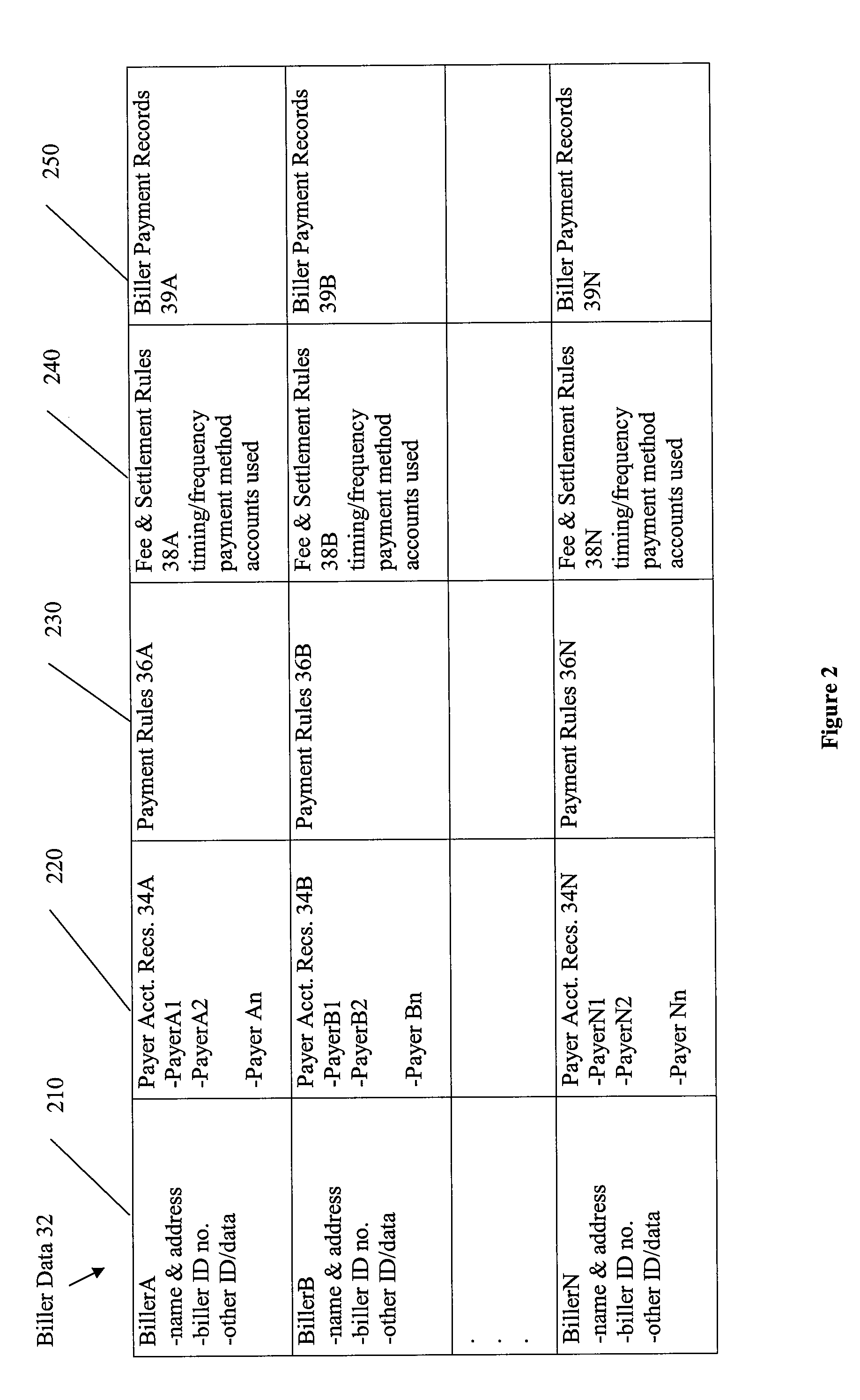

Electronic bill payment with variable payment options

Owner:MONEYGRAM INT

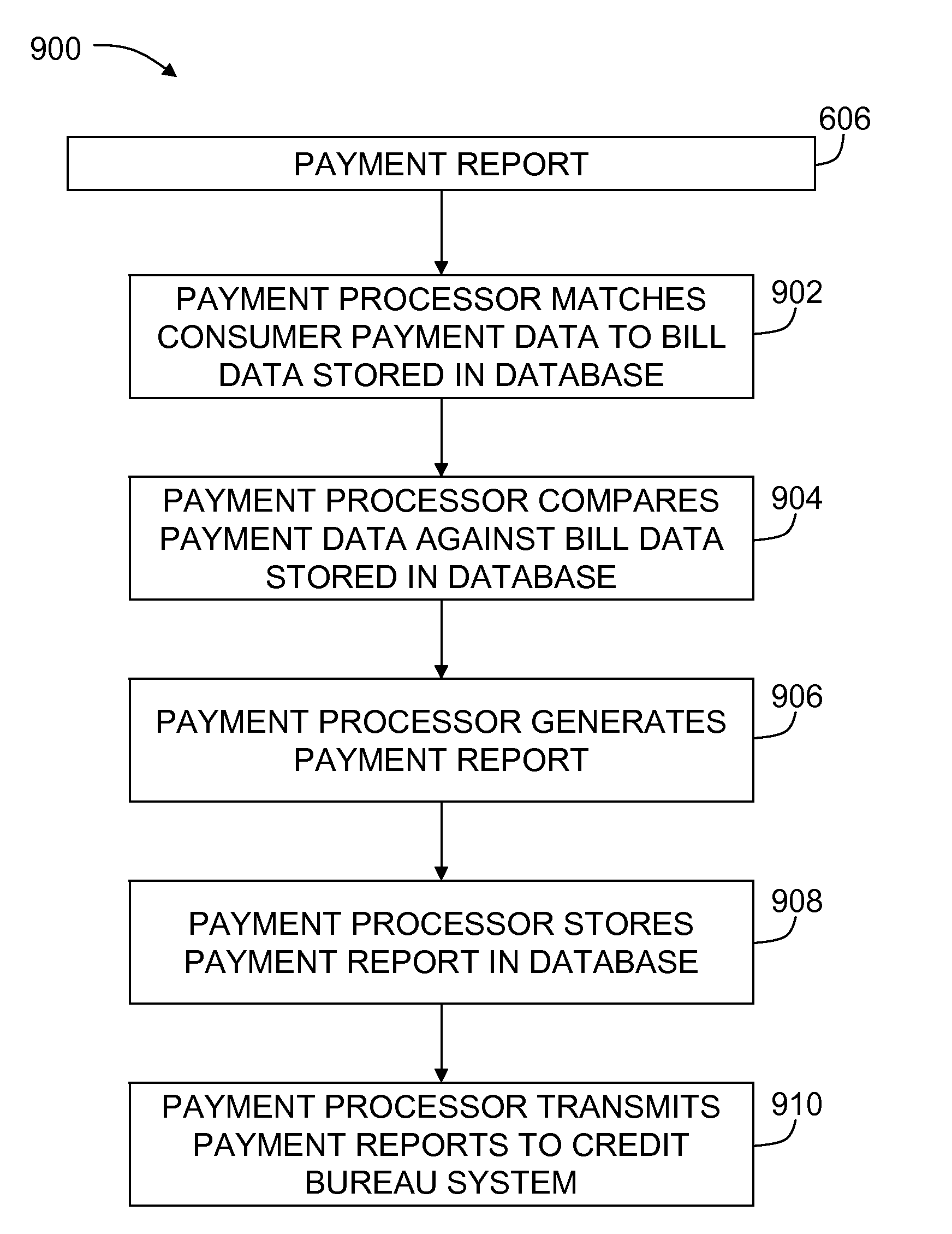

Methods and systems for biller-initiated reporting of payment transactions

Owner:MASTERCARD INT INC

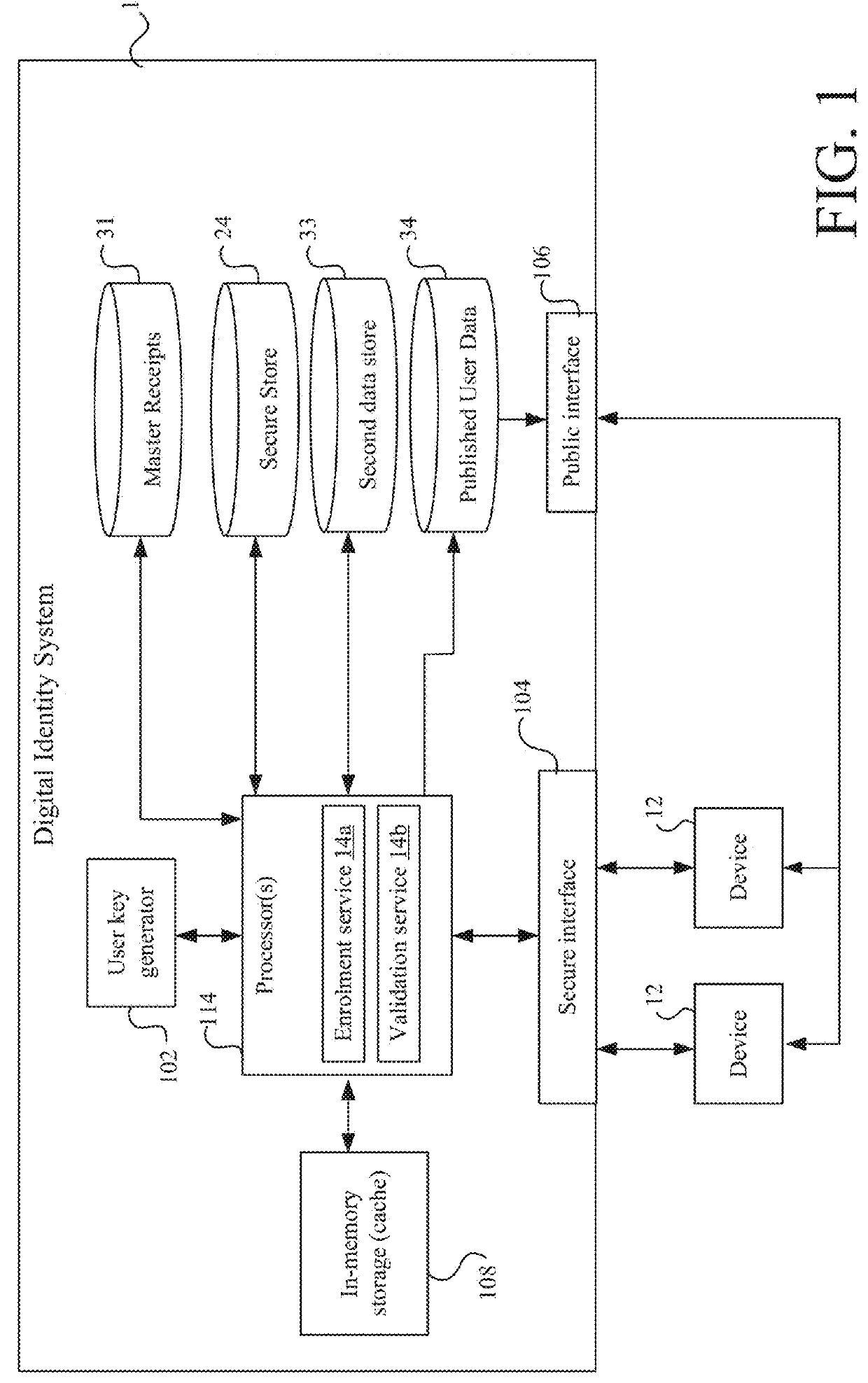

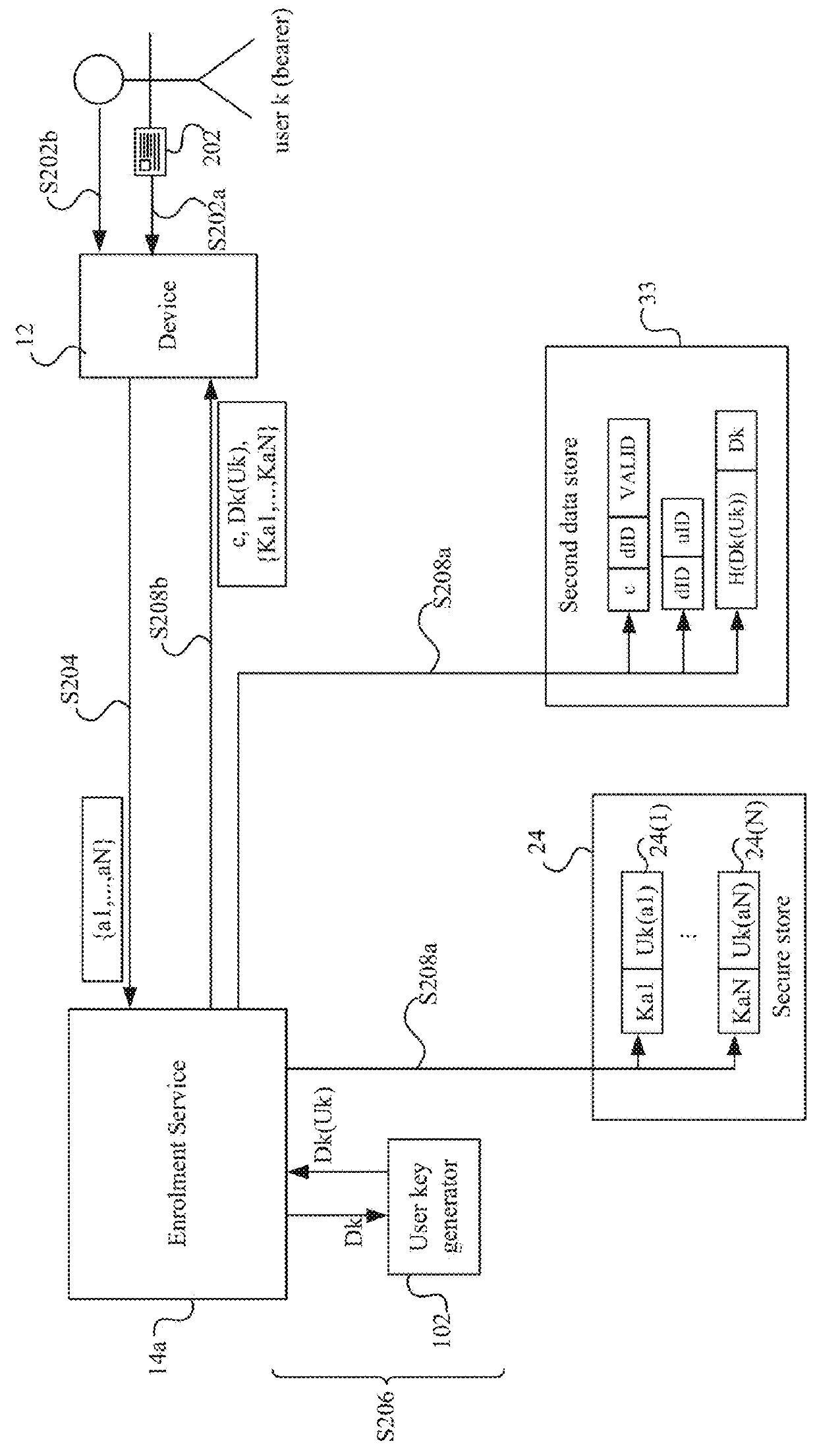

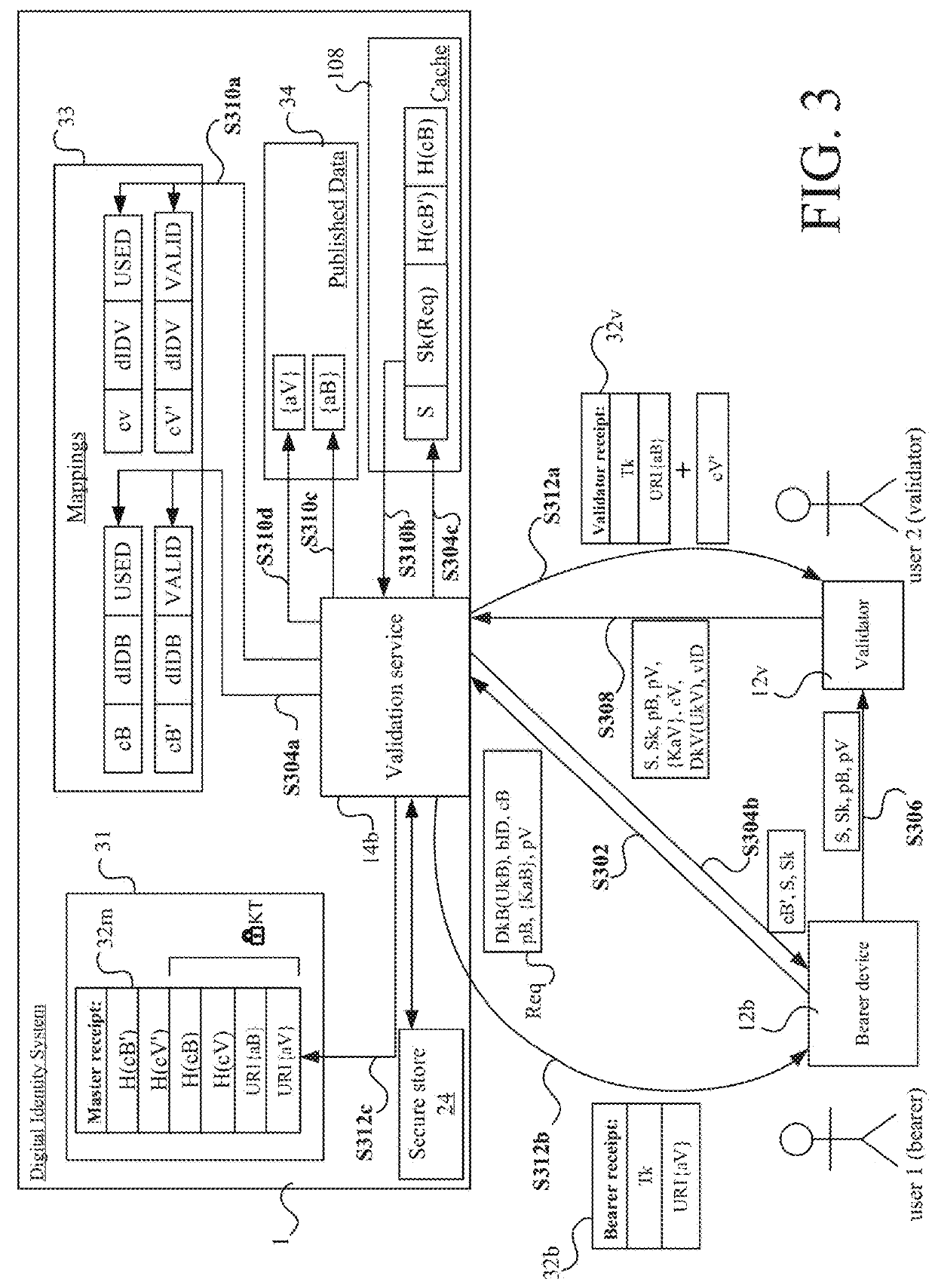

Secure Electronic Payment

ActiveUS20180181964A1Secure and efficient mechanismElectronic credentialsProtocol authorisationDigital identityPayment

A method of authorizing a secure electronic payment from a payer to a payee. At a digital identity system, an electronic message is received, which comprises a payer credential and identifies a payee system. At the digital identity system, a digital identity associated with the payer credential is accessed, the digital identity comprising: 1) at least one identity attribute or data for deriving at least one identity attribute, and 2) a payment token or data for obtaining a payment token, the payment token for effecting an electronic payment from the payer to a recipient of the payment token. At least one electronic message is transmitted from the digital identity system to the payee system to render the identity attribute and the payment token available to the payee system, for determining, based on the identity attribute rendered available to the payee device, whether to use the available payment token to effect an electronic payment from the payer to the payee.

Owner:YOTI HLDG LTD

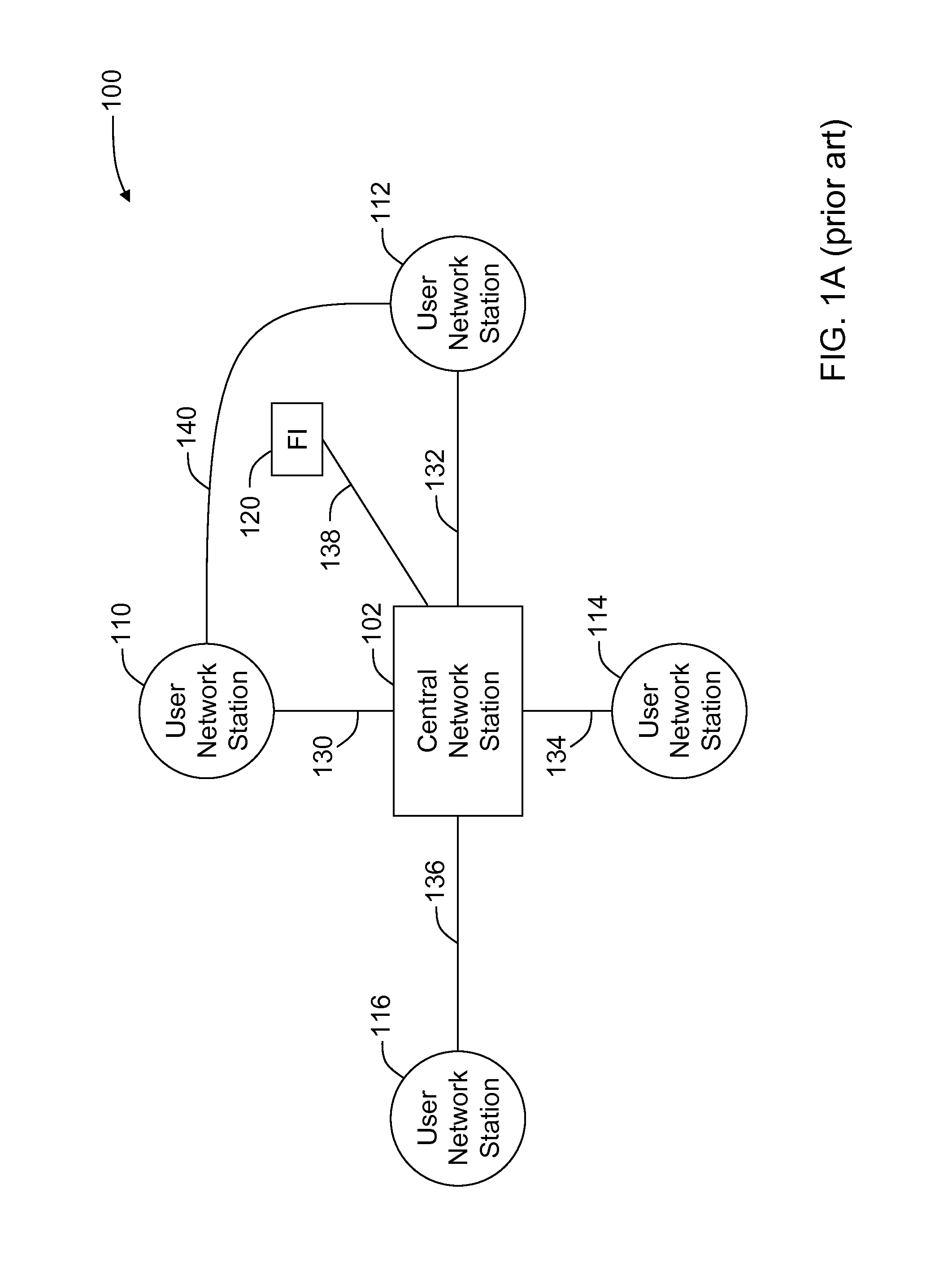

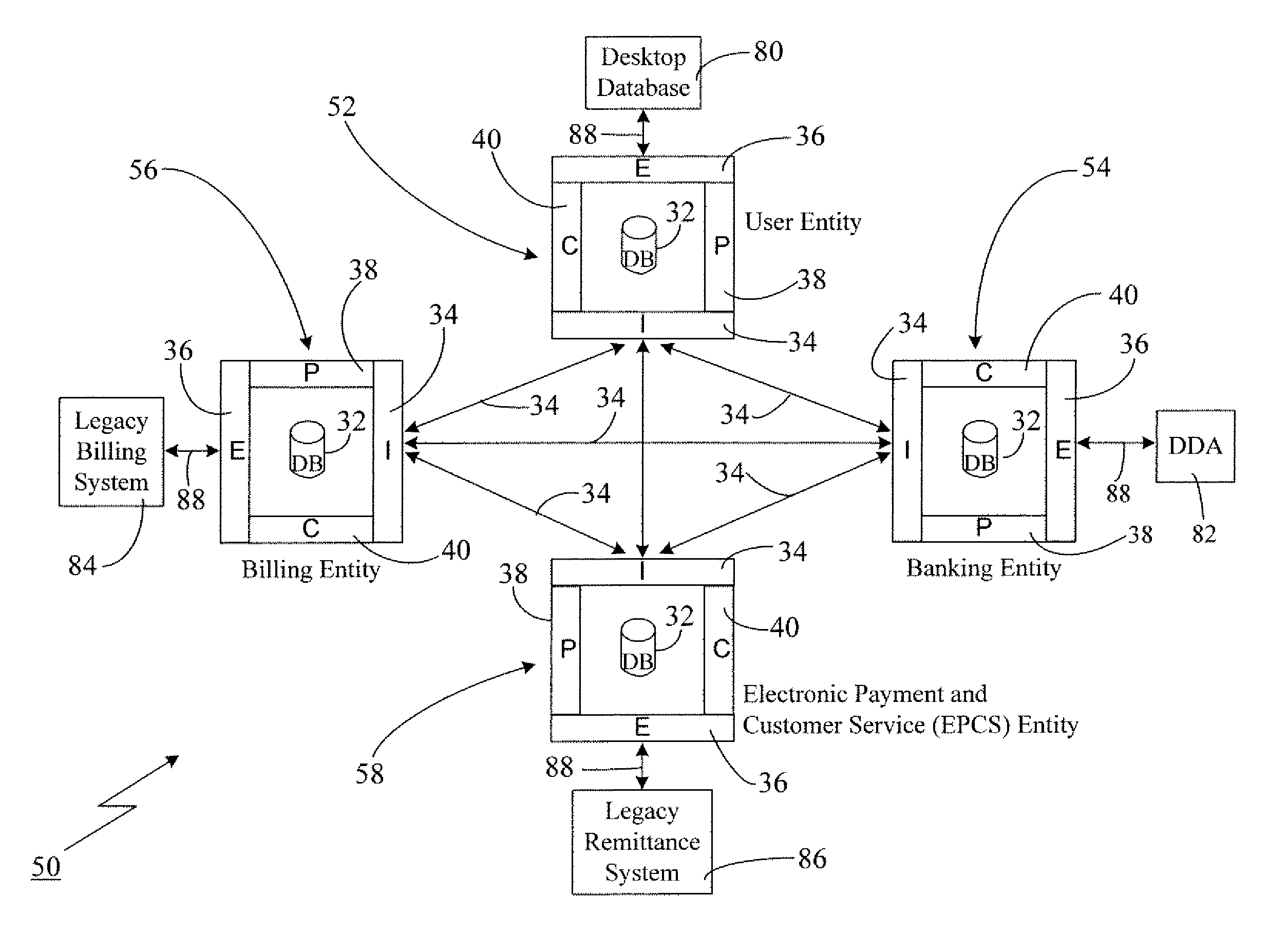

Electronic billing with updateable electronic bill summary

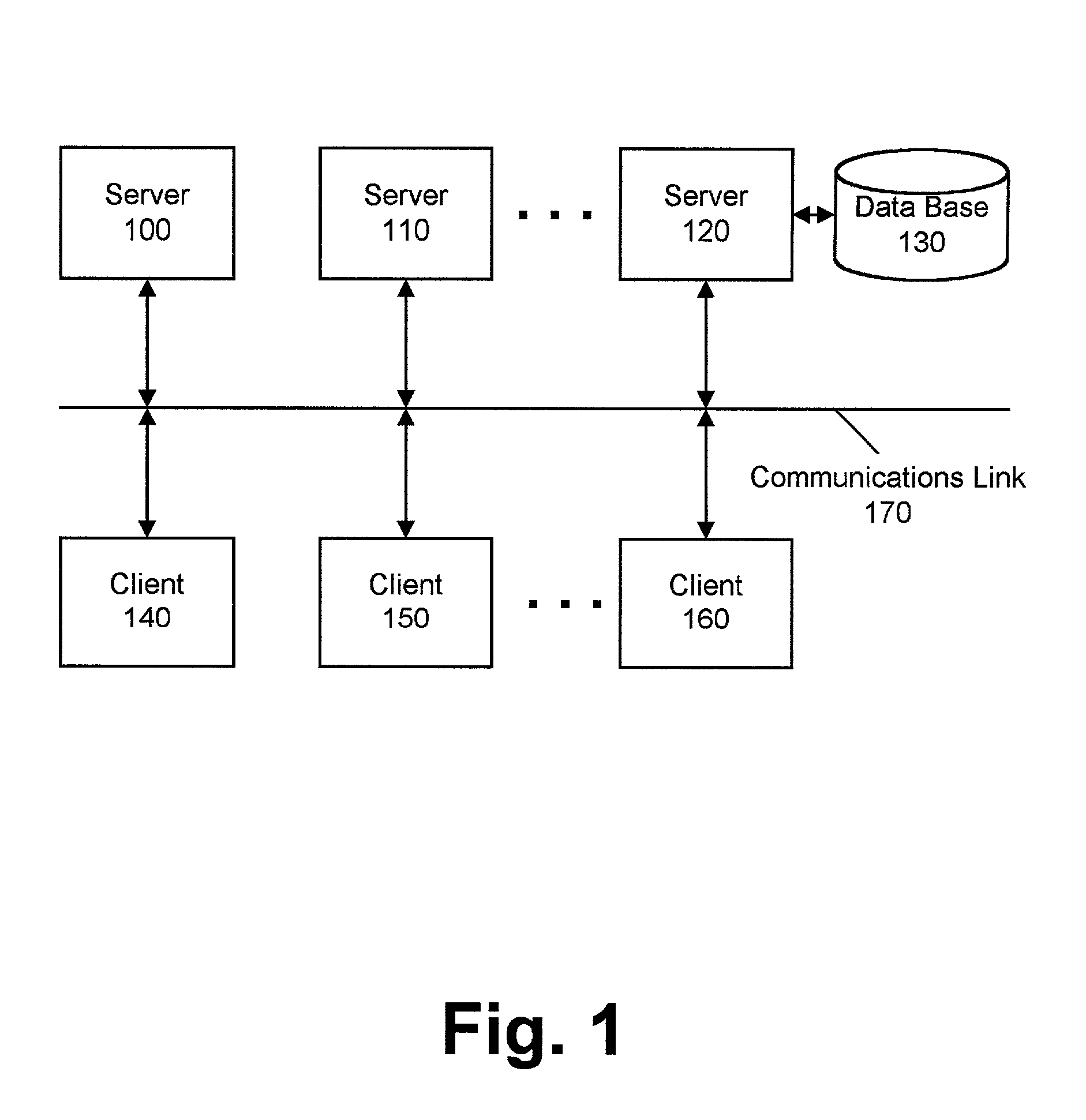

InactiveUS7392223B1Easily implemented using computer softwareEasy programmingComplete banking machinesFinanceTelecommunicationsMobile station

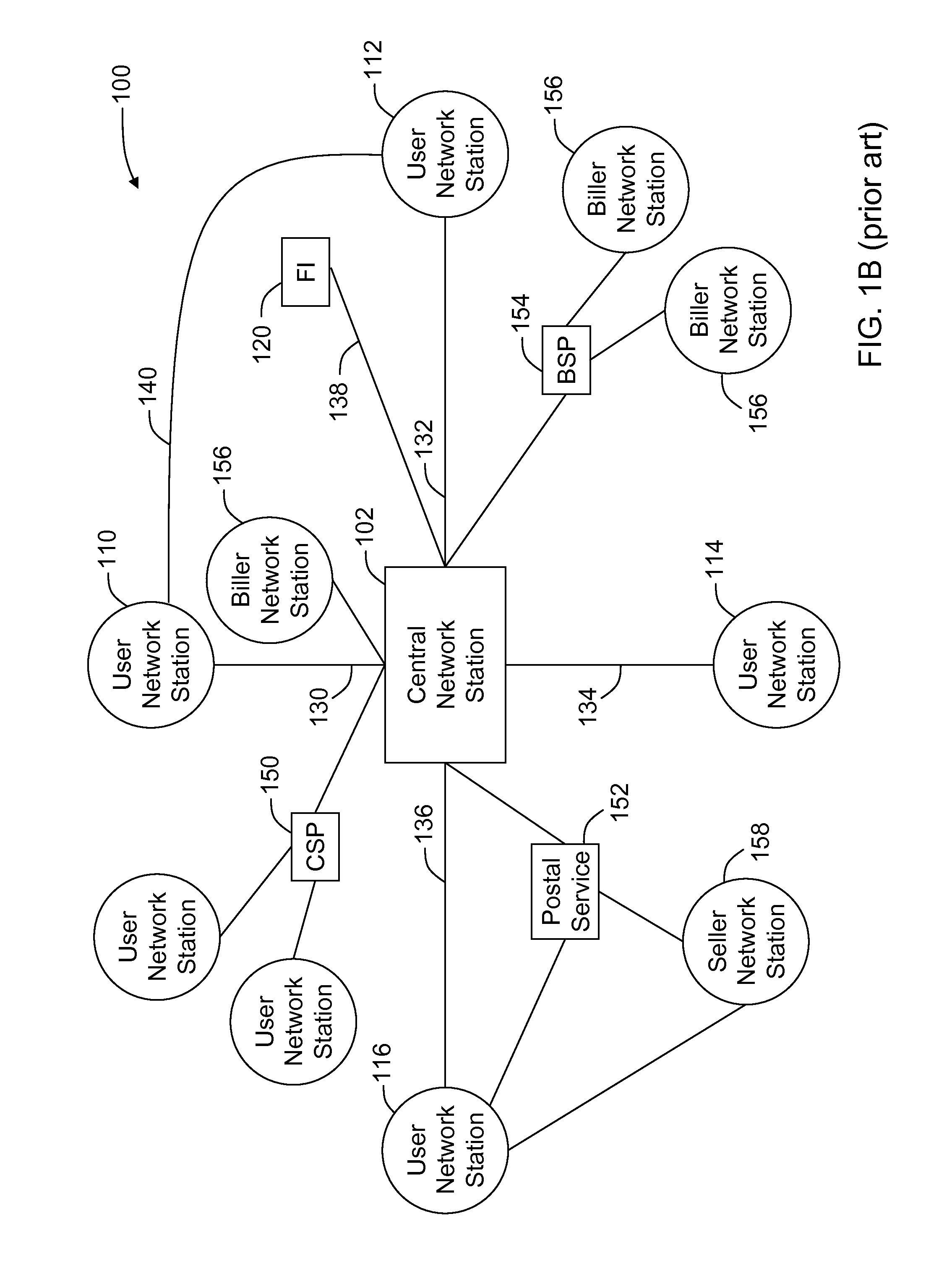

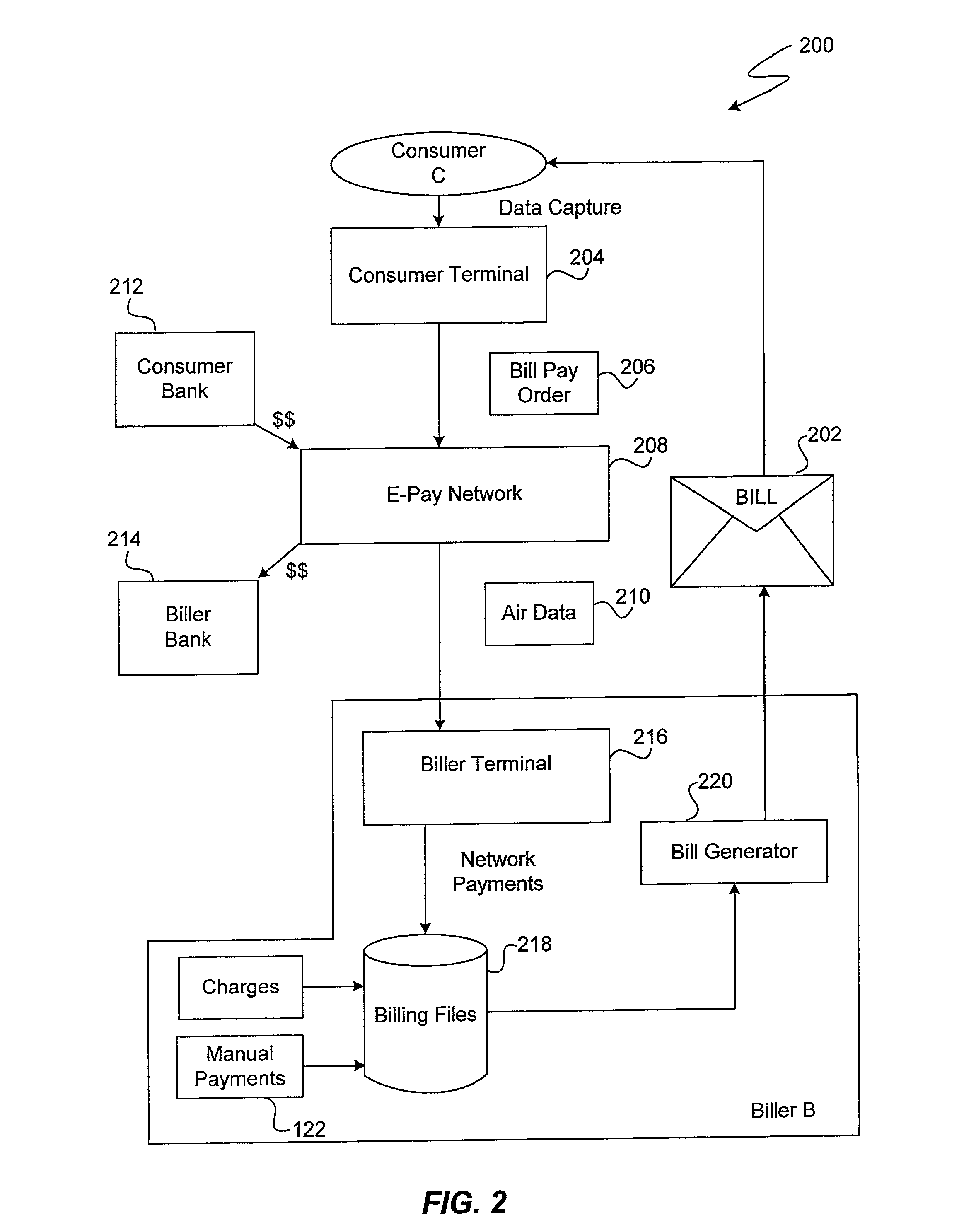

An electronic bill payment network includes a plurality of user network stations associated with different users, a plurality of biller network stations associated with different billers, and a central network station. A first user station operates, in real time, to transmit information relevant to an amount of an available bill and an instruction to pay the available bill. A first biller station operates, in real time, to receive the transmitted information and to compute the amount of the available bill based upon the received information. The central network station operates to receive the computed amount of the available bill and the transmitted pay instruction, and to direct payment of the computed amount of the available bill based upon the transmitted instruction to pay that bill.

Owner:CHECKFREE CORP

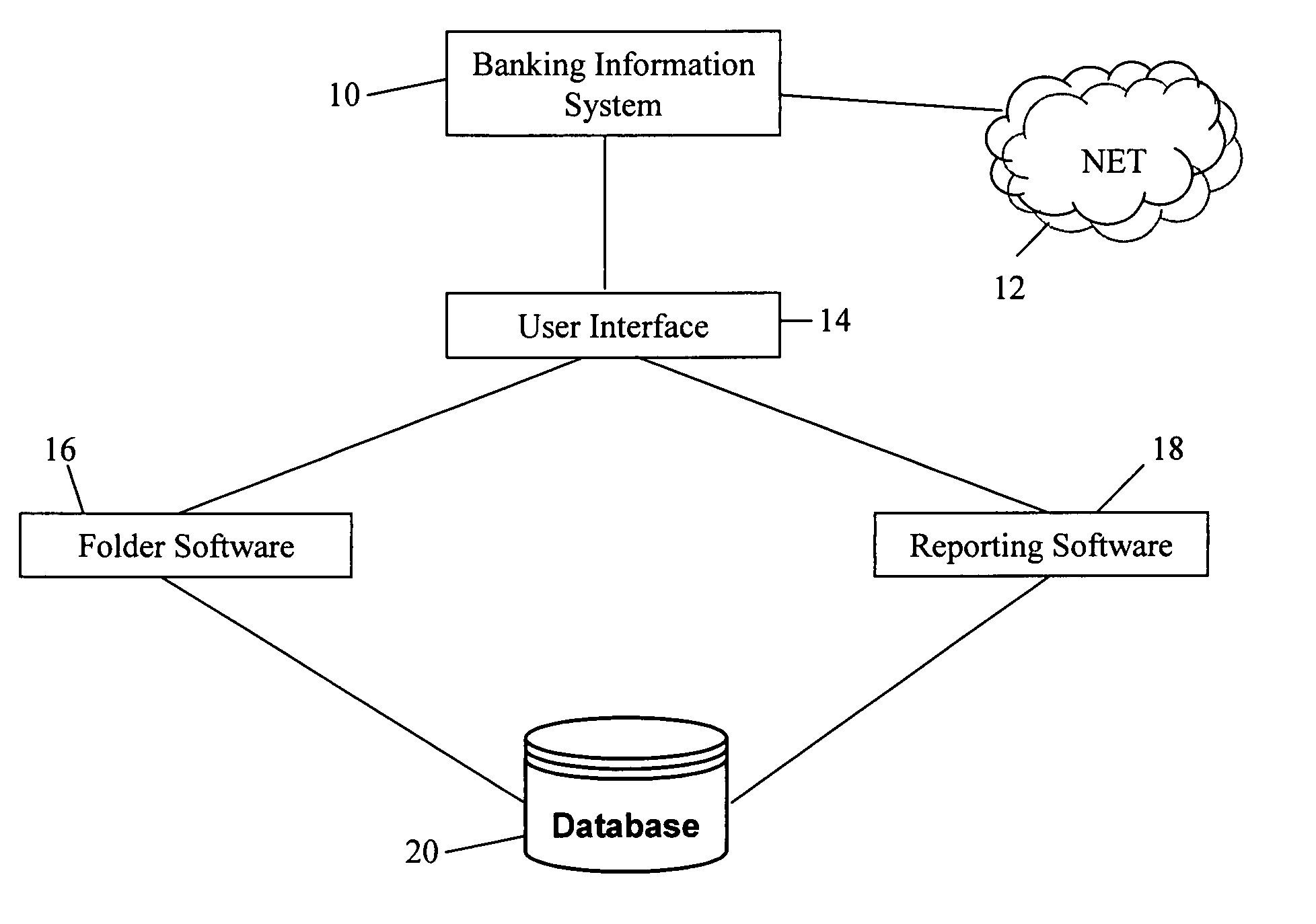

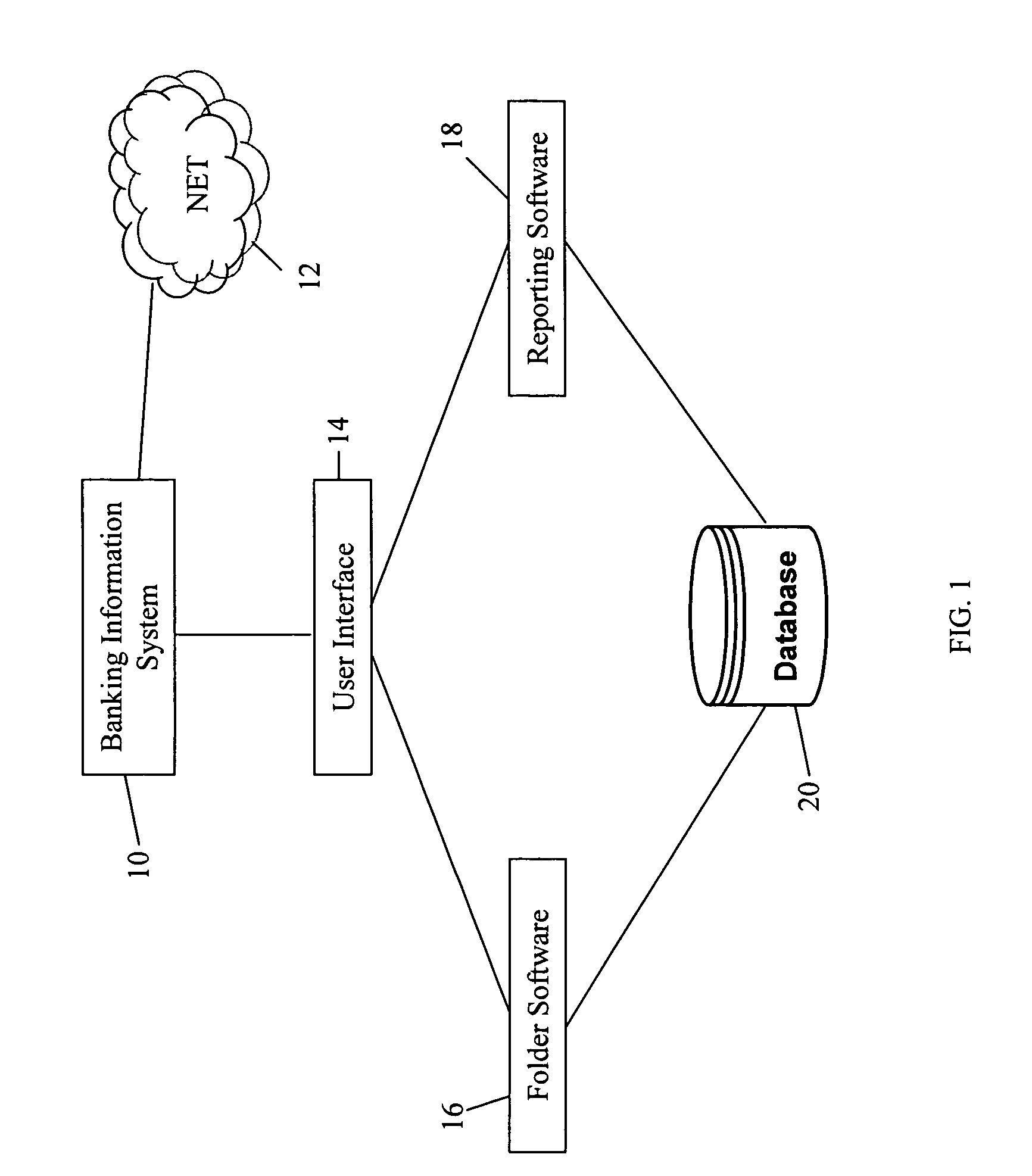

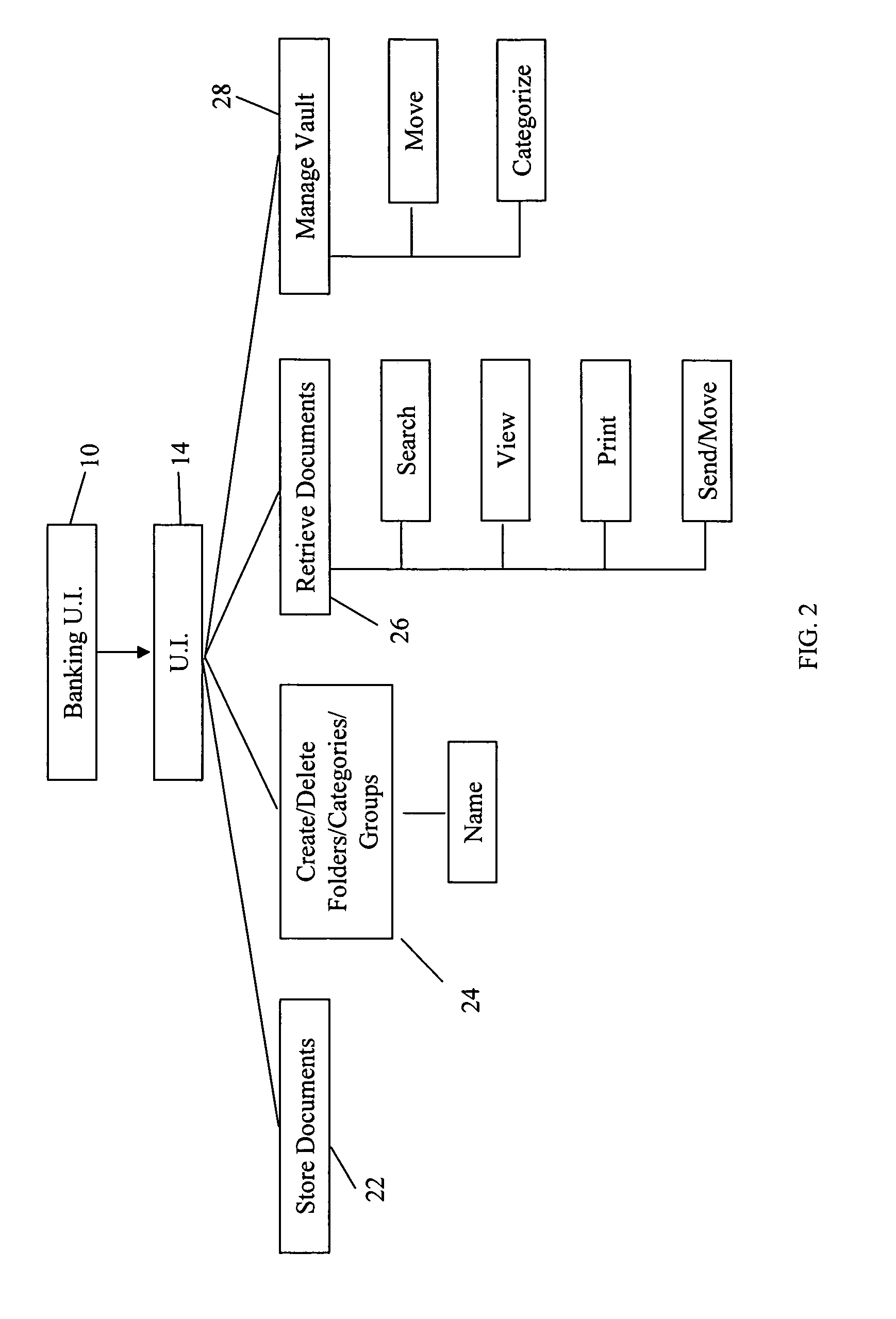

System and method for storing, creating, and organizing financial information electronically

InactiveUS20050203885A1Safe storageFinanceDigital data processing detailsAccess historyIdentity theft

A system and / or method which offers customer-driven aggregation of data, with the ability to dynamically modify the filing hierarchy and to store, create and organize digital financial information. The system enables customers to establish a hierarchy of file folders, file any payment whether paper or electronic in a folder for future reference, provide secure storage for an indefinite period for any payment, including credit card payments, debit card transactions, imaged checks, electronic bill payments or account statements. As such, customers can create and change at will their file folder hierarchy and file documents with notes. Customers can set a preference for automatic filing based on pre-established criteria such as folders based standard merchant categories or by month. Customers can also ‘file’ payments when they are created or viewed in the transaction history. The systems of the exemplary embodiments provide a search function, enabling retrieval of documents based on a document storage time stamp, date last accessed, date posted, dollar amount, or by file folder, group, or category. Customers can view document access history. Further, the systems offer customers convenience, privacy, security and prevention of document loss from disaster, and protection from document or identity theft.

Owner:U S BANK NAT ASSOC

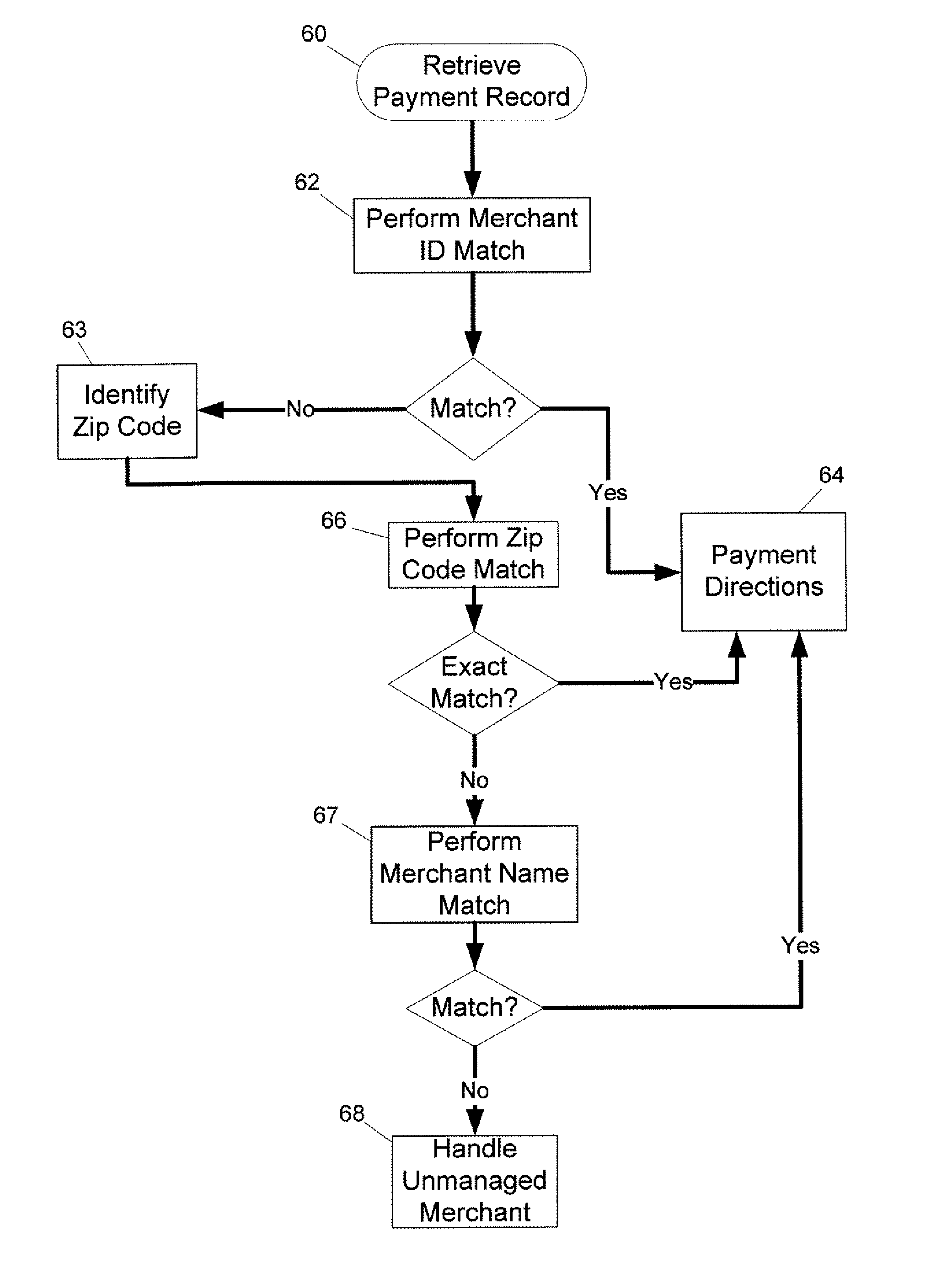

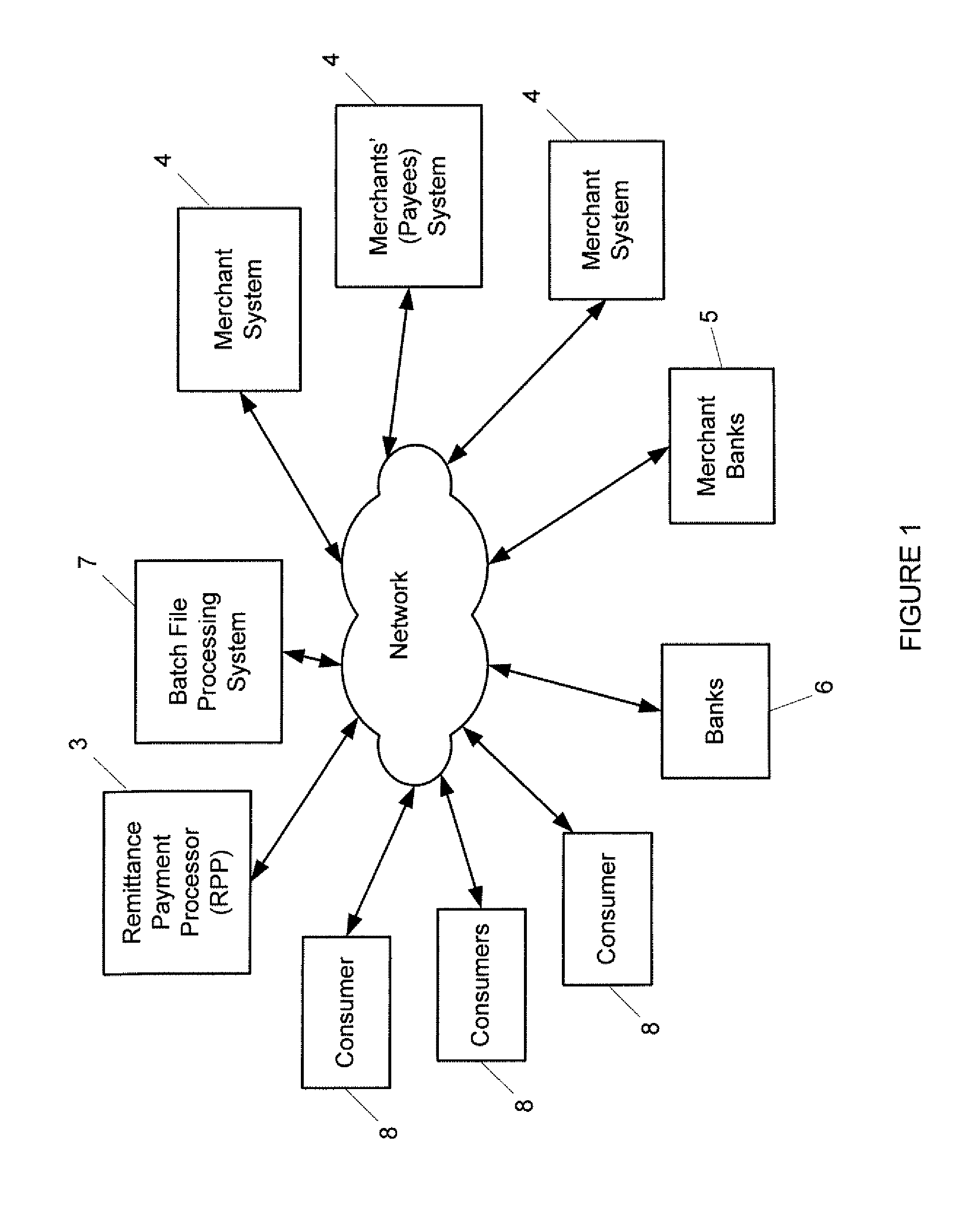

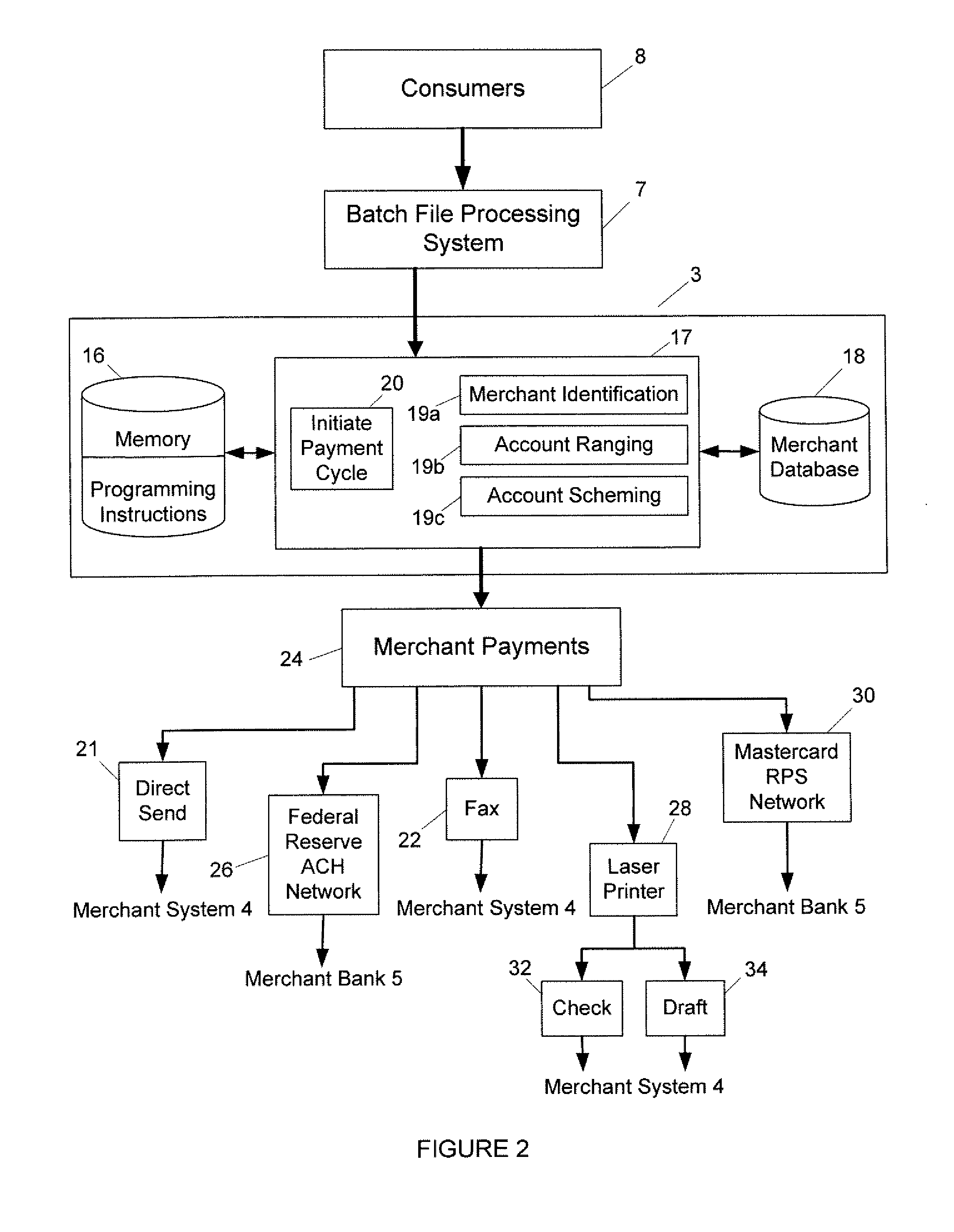

Electronic bill payment system with merchant identification

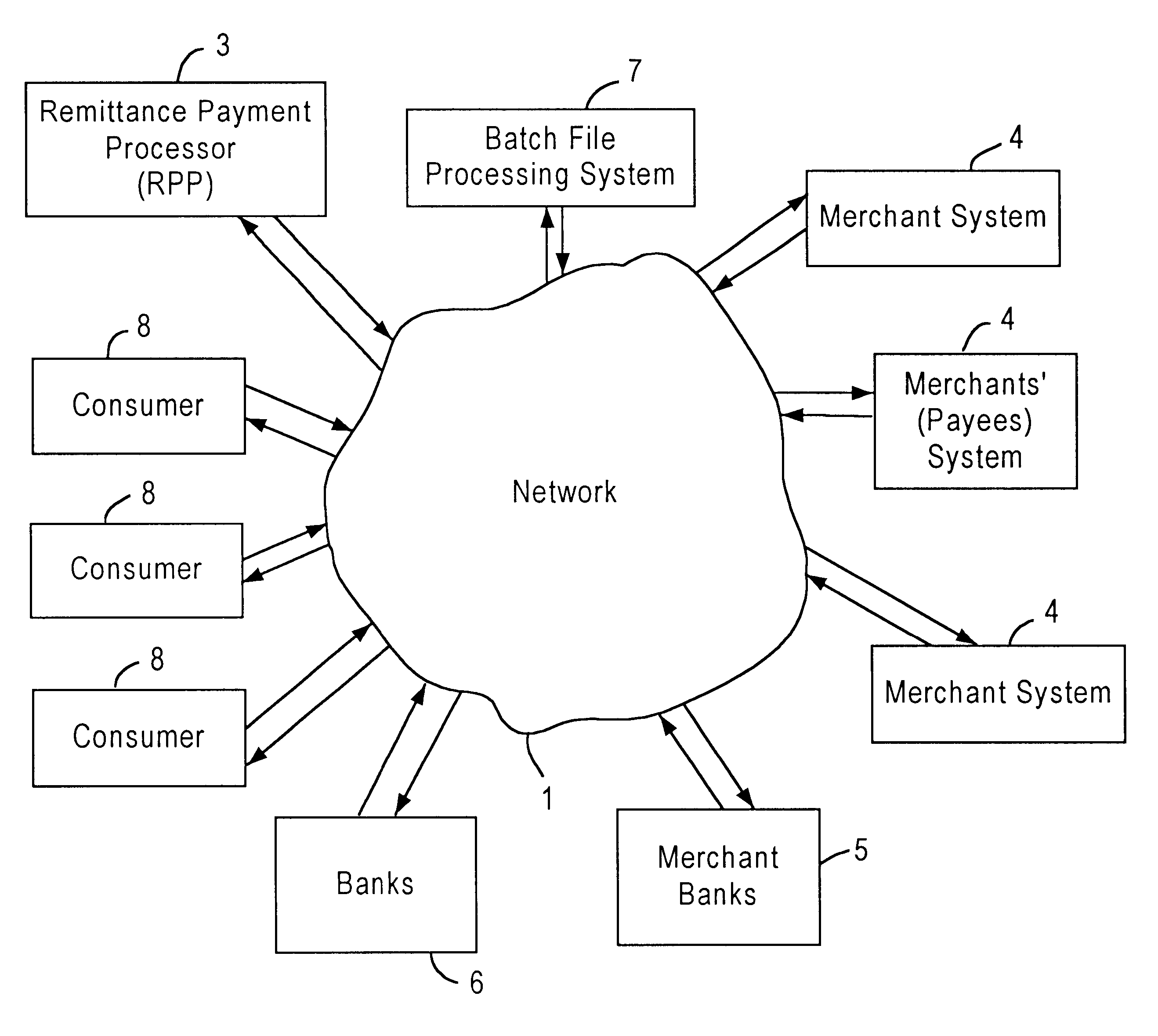

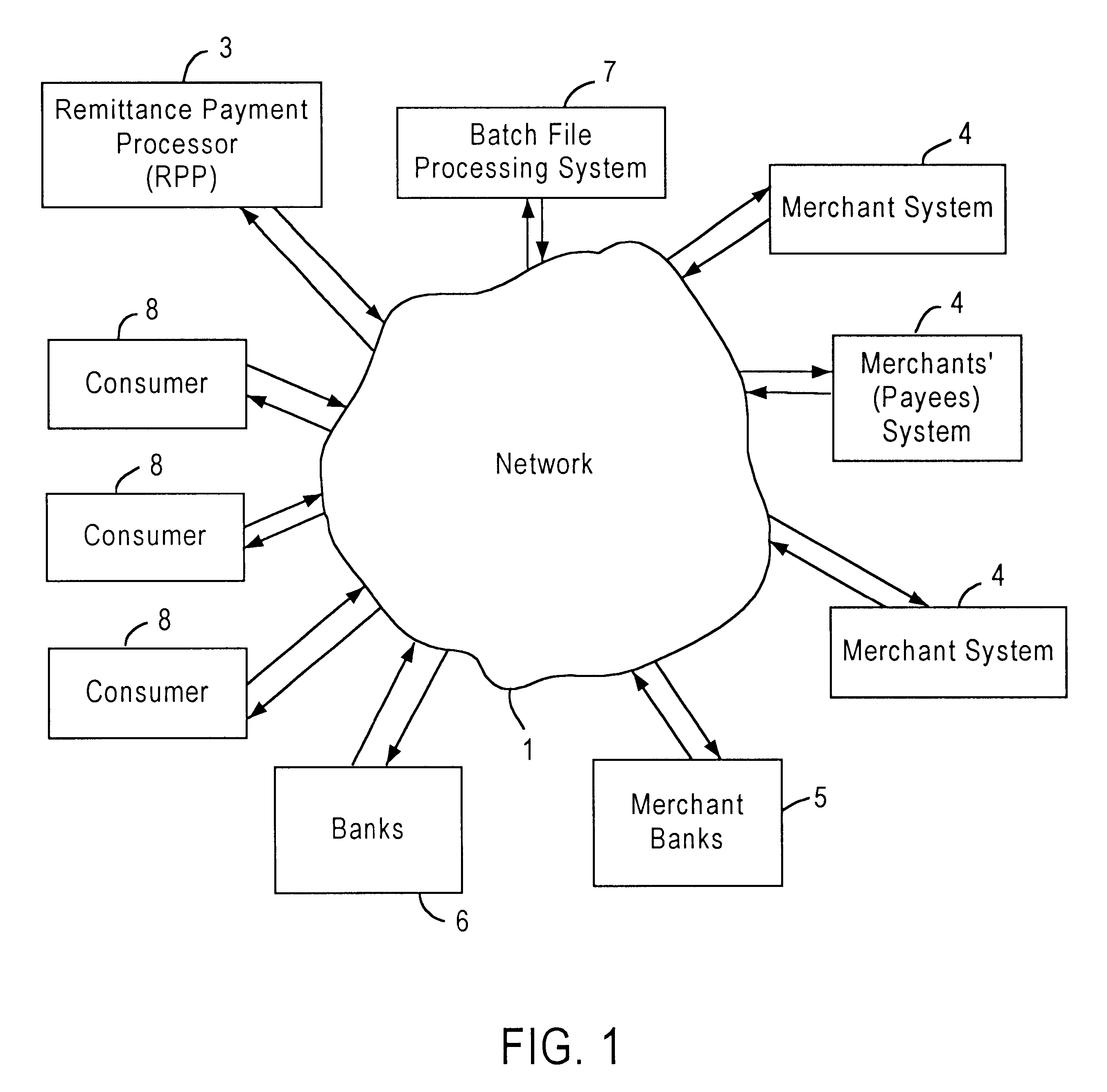

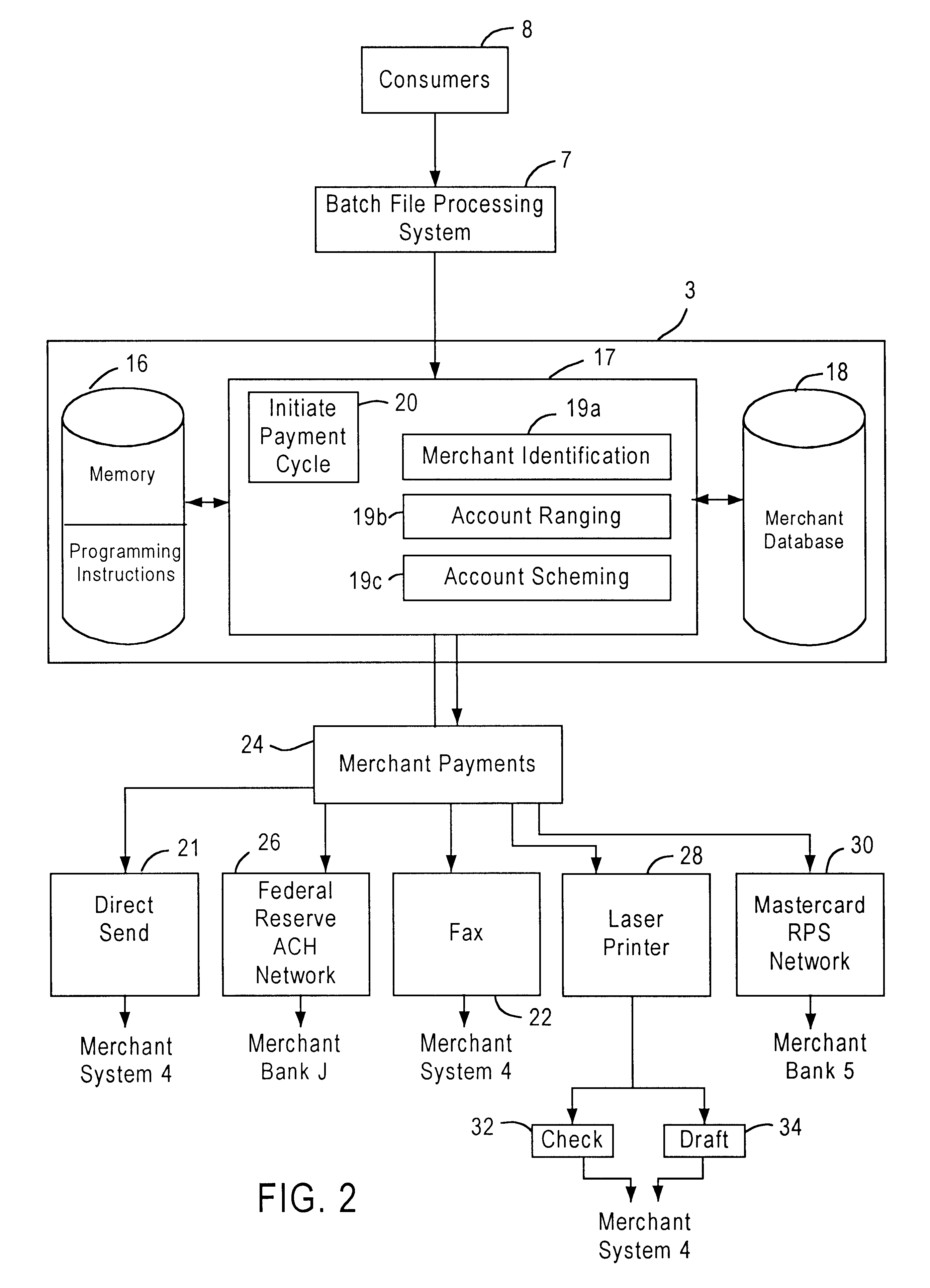

A computer implemented system and method for payment remittance receives a payor's payment information, processes this payment information, other than a received zip code, to identify an eleven digit zip code for a payee. The system and method then accesses a database of payee records to locate a payee record corresponding to the eleven digit zip code.

Owner:CHECKFREE CORP

Integrated File Structure Useful in Connection with Apparatus and Method for Facilitating Account Restructuring in an Electronic Bill Payment System

ActiveUS20100174644A1Facilitating account restructuringEasy to useComplete banking machinesFinancePayment transactionPayment order

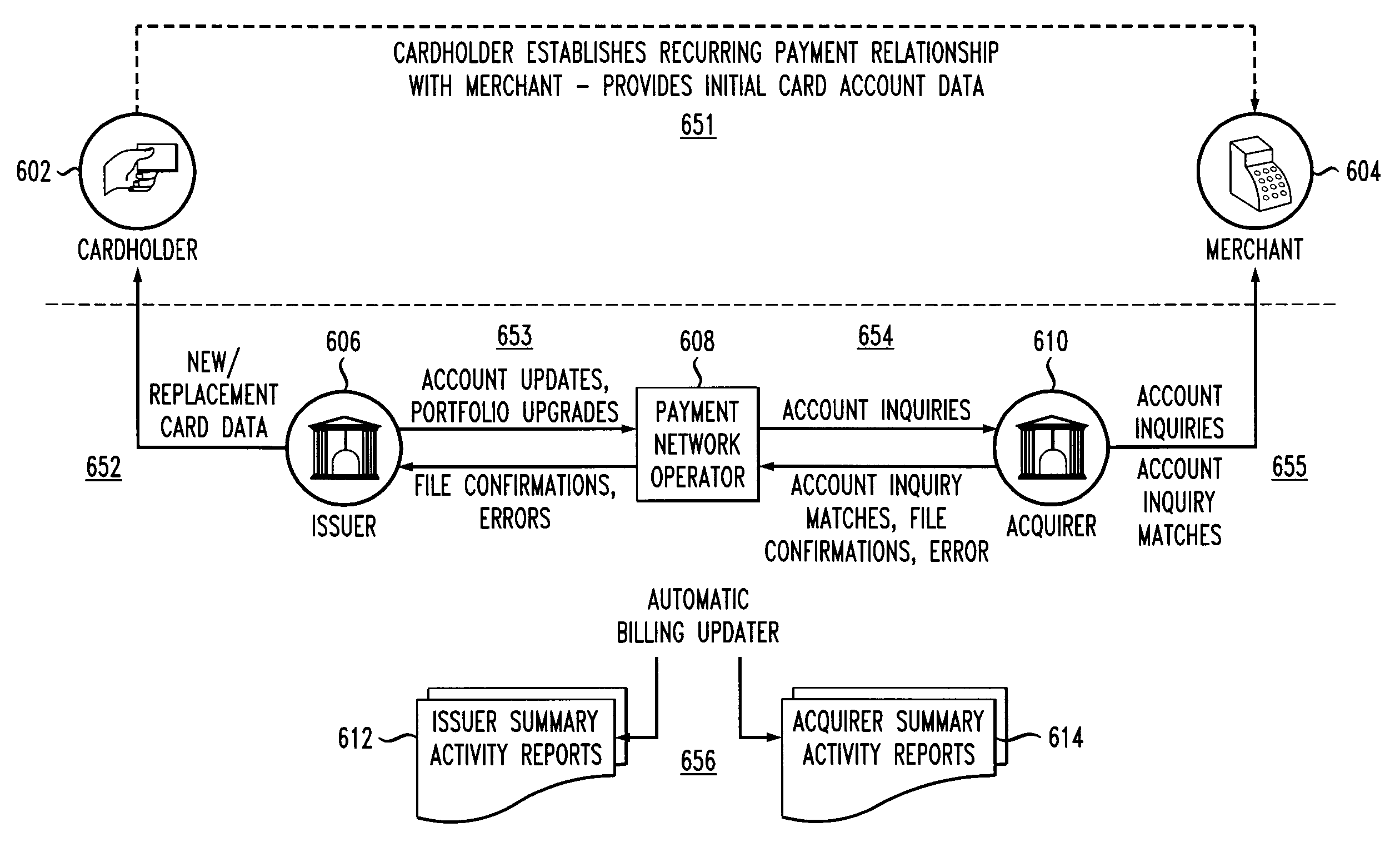

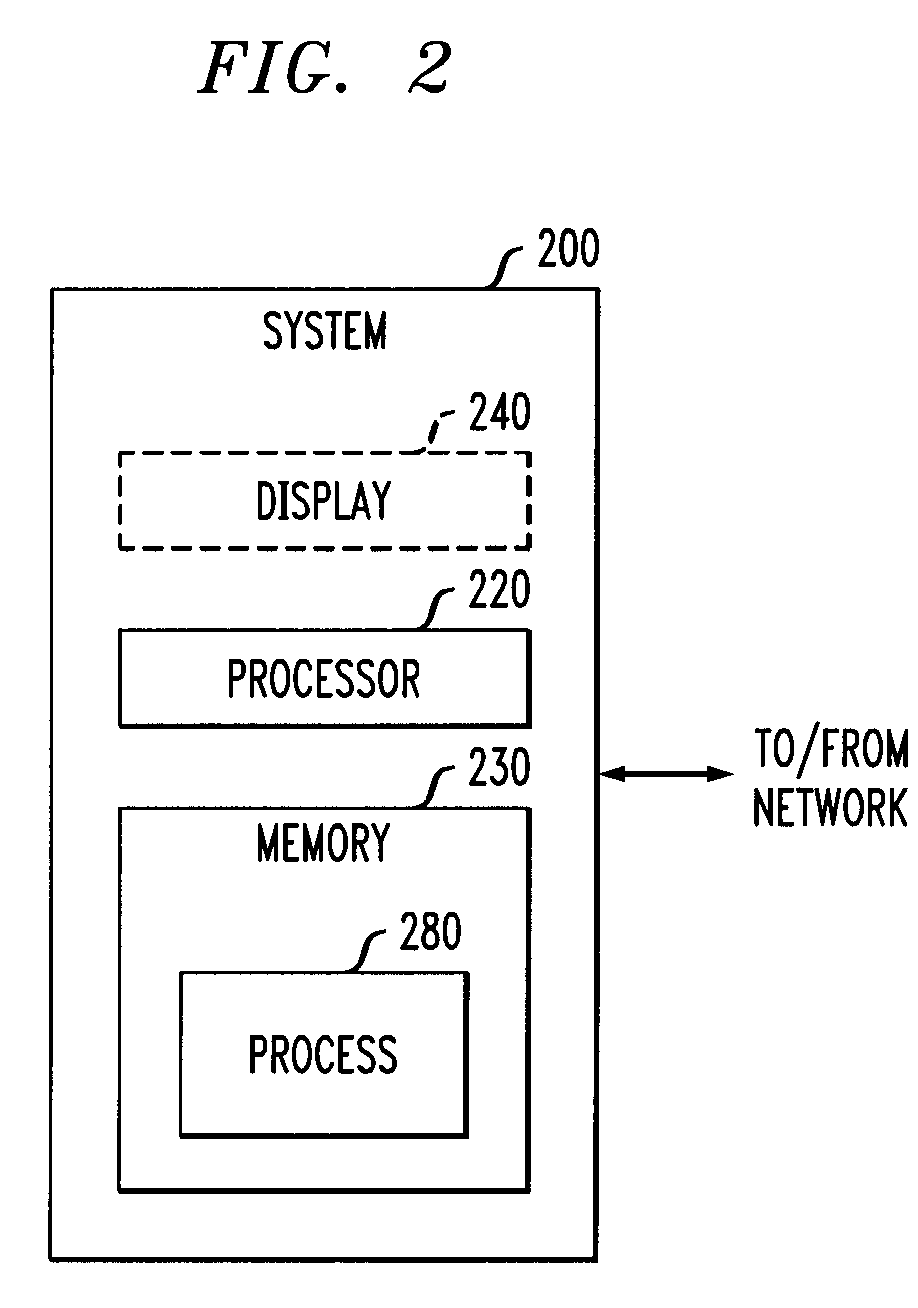

An electronic funds transfer bill payment operation of a financial institution receives first information representing an account restructuring of a biller which uses the electronic funds transfer bill payment operation. The first information is combined with second information into a uniformly formatted file. The second information is formatted differently than the first information. The second information includes card update information for recurring payment card payments made with payment cards issued by the financial institution. The uniformly formatted file is transferred to an operator of a payment network of a kind configured to facilitate transactions between multiple issuers and multiple acquirers. The uniformly formatted file specifies at least one old account number associated with a biller and at least one new account number associated with the biller. The payment network operator operates both a recurring payment transaction system for card-not-present recurring payments and an electronic funds transfer account conversion application in accordance with the uniformly formatted file.

Owner:MASTERCARD INT INC

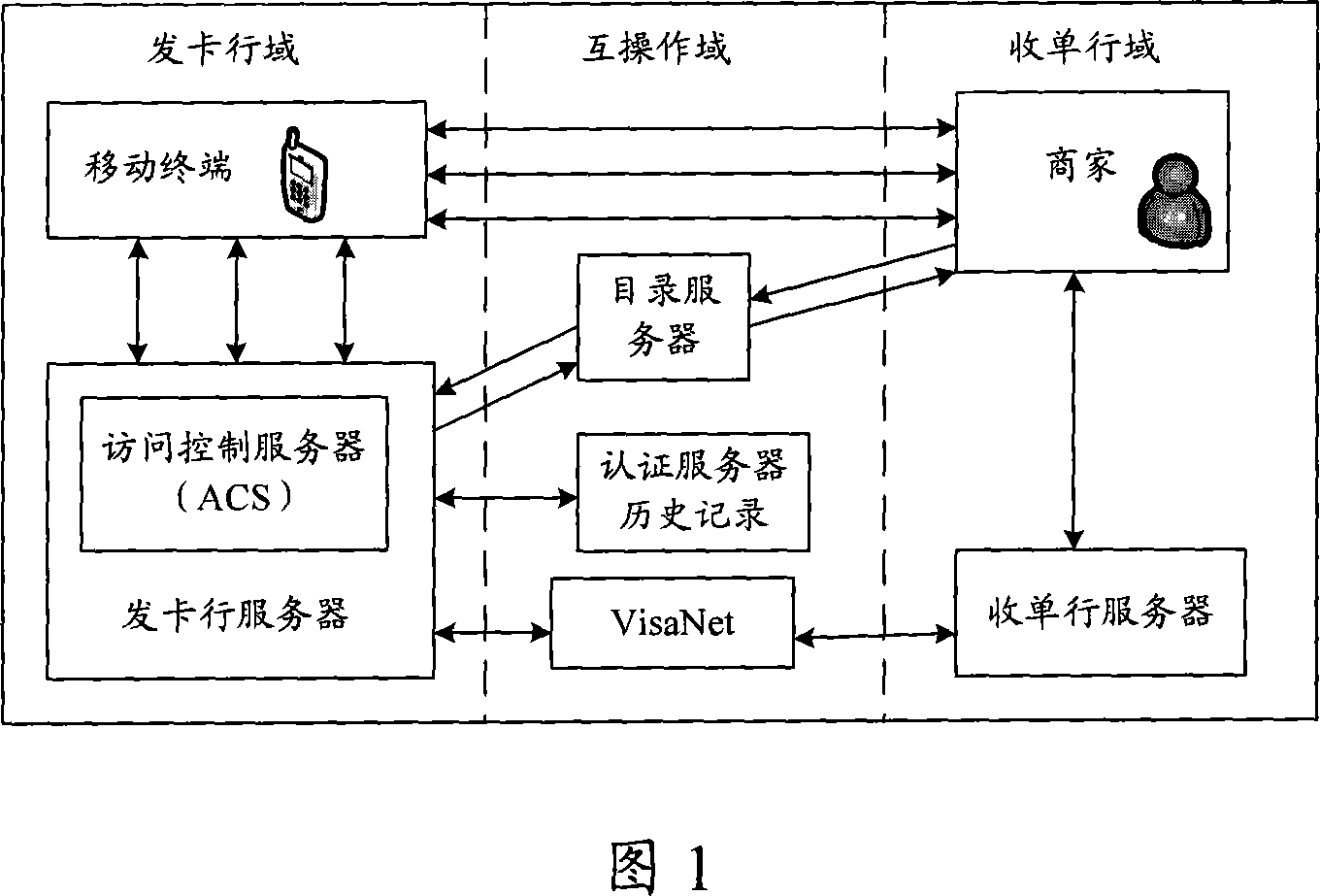

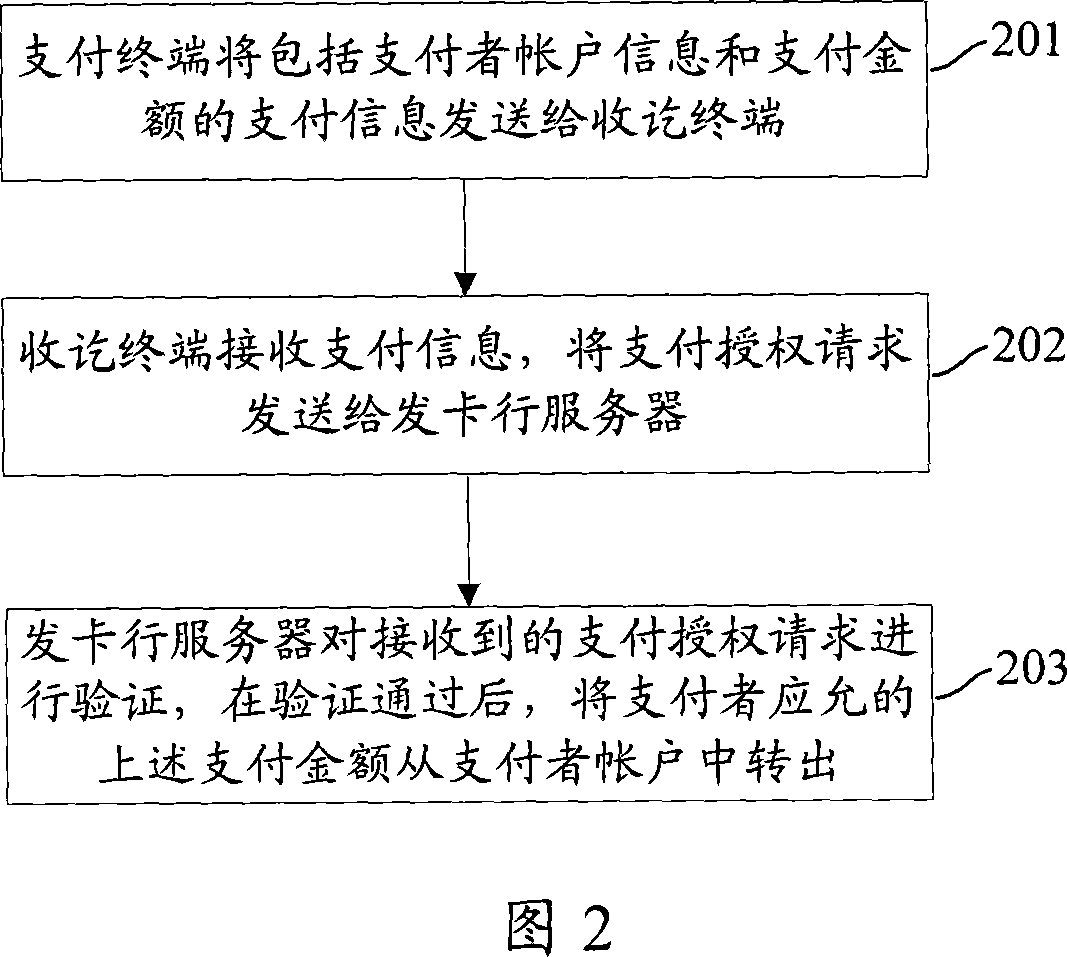

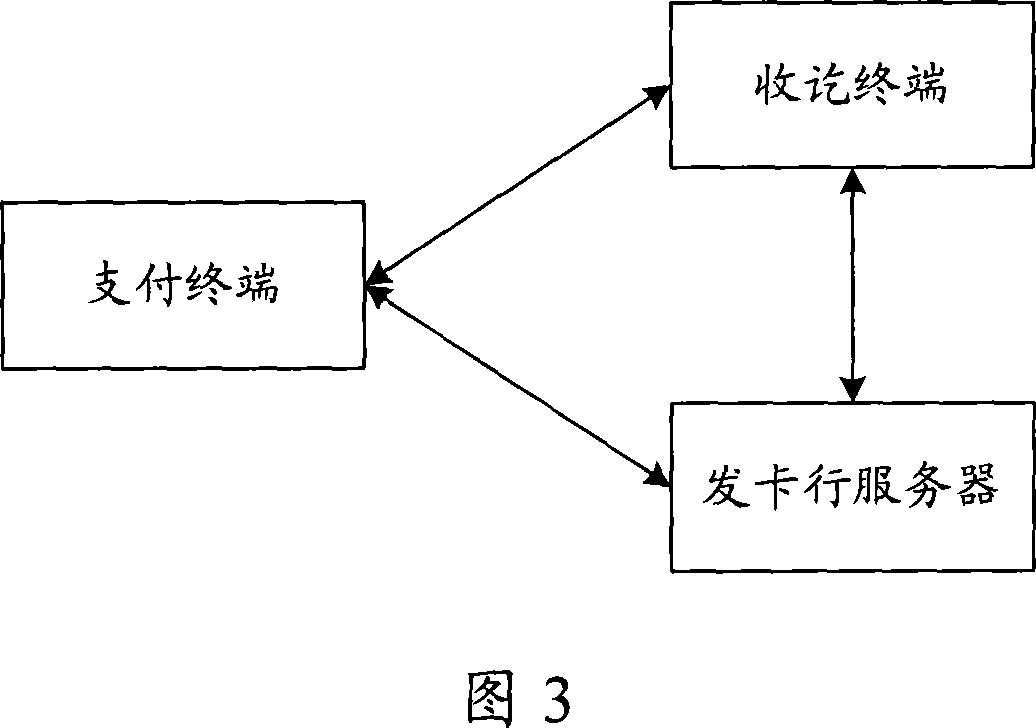

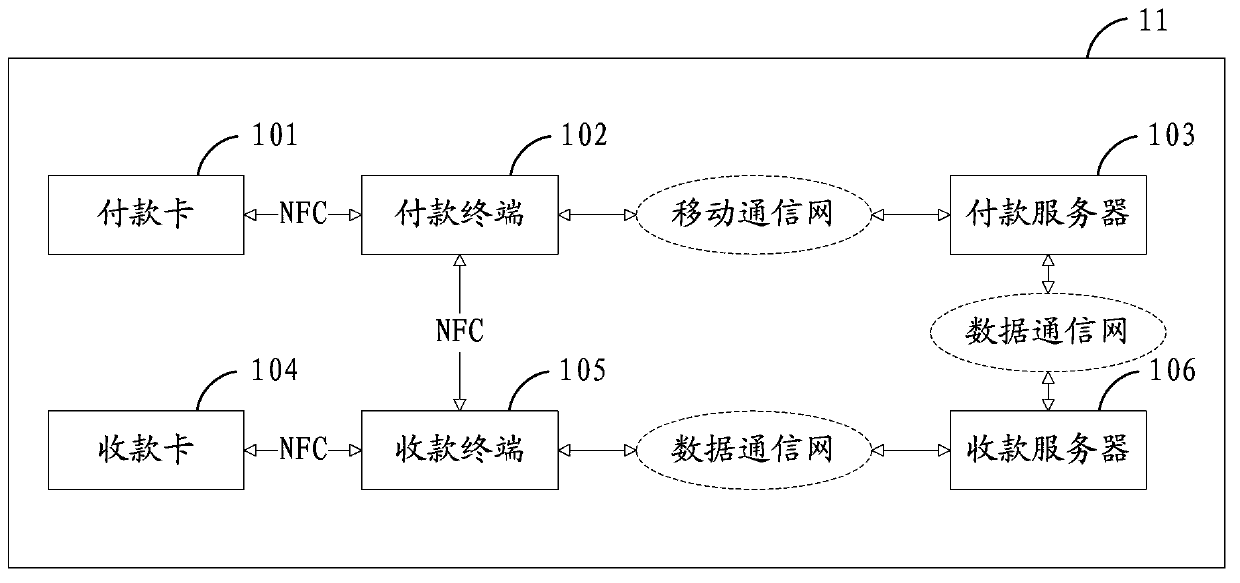

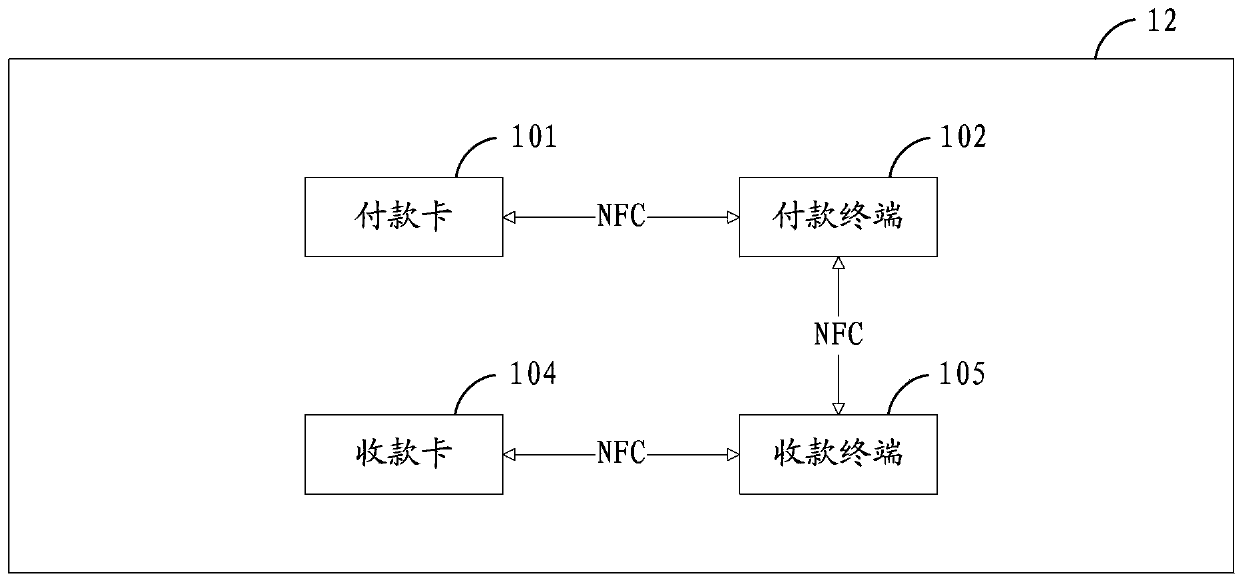

Method, system and mobile terminal for implementing electronic payment

InactiveCN101034449AReduce communication burdenReduce repetitionPayment architectureComputer scienceAuthorization

The invention provides a method of realizing of implementation of electronic payment, including: payment terminals sent account information of payer and payment information of the amount of payment to payment terminals of the receipter ;terminals of the receipter receive above information, the payment authorized request will be sent to issuers server, the request under the carry - information received and pay those accounts, including received information; issuers server verificates the received payment authorization request a, after the passage of the test, it will transfer account that payer who promised the stated amount. The implementation of this invention also provides a method based on the realization of electronic payment systems and mobile terminals. The technical implementation of the program provided by the invention will reduce repeated transmission of information during the whole process of payment, predigest payment streamline, and therefore reduce the burden of payment terminal communications, reduce communication costs and save transmission resources.

Owner:HUAZHONG UNIV OF SCI & TECH +1

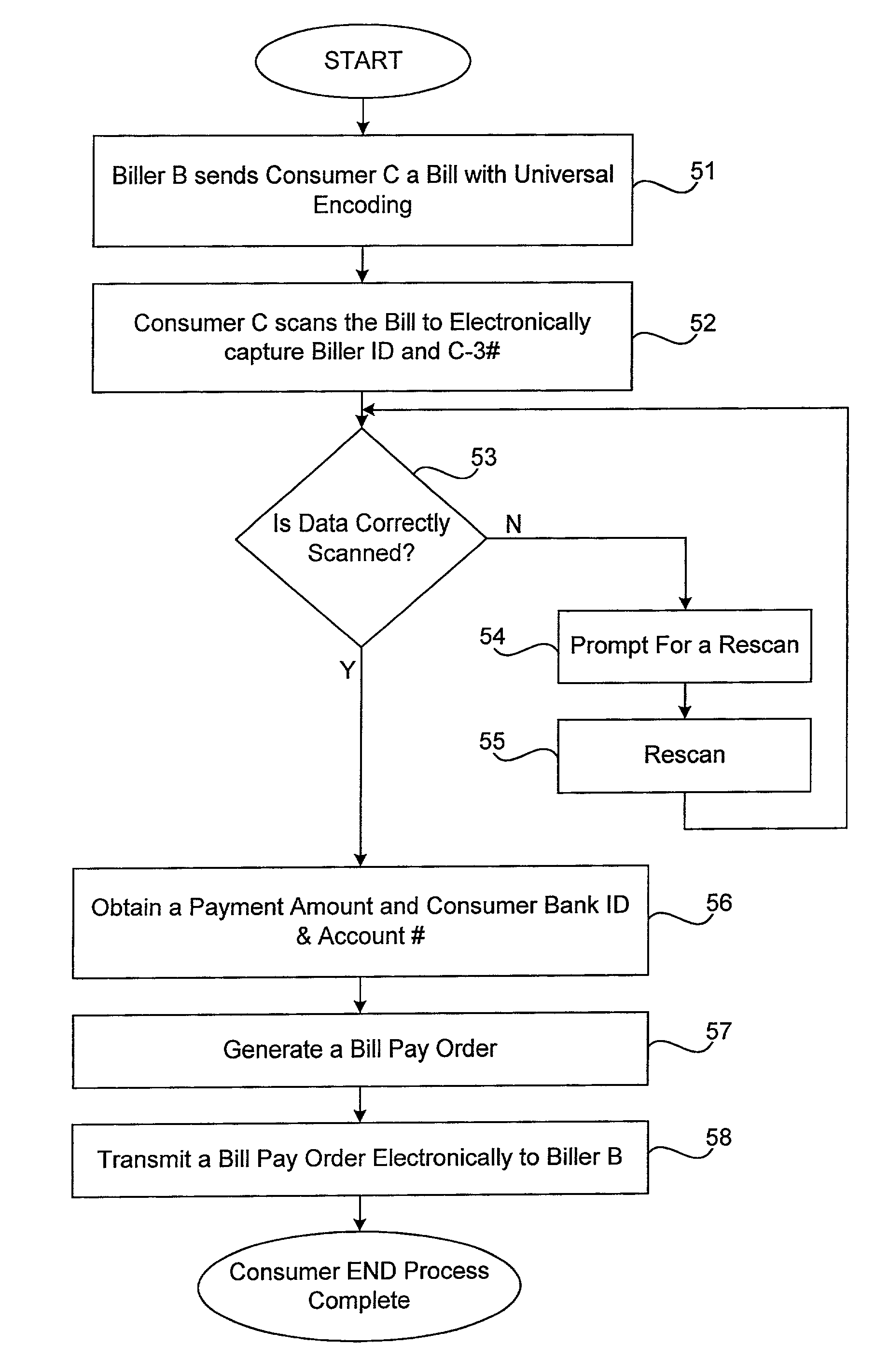

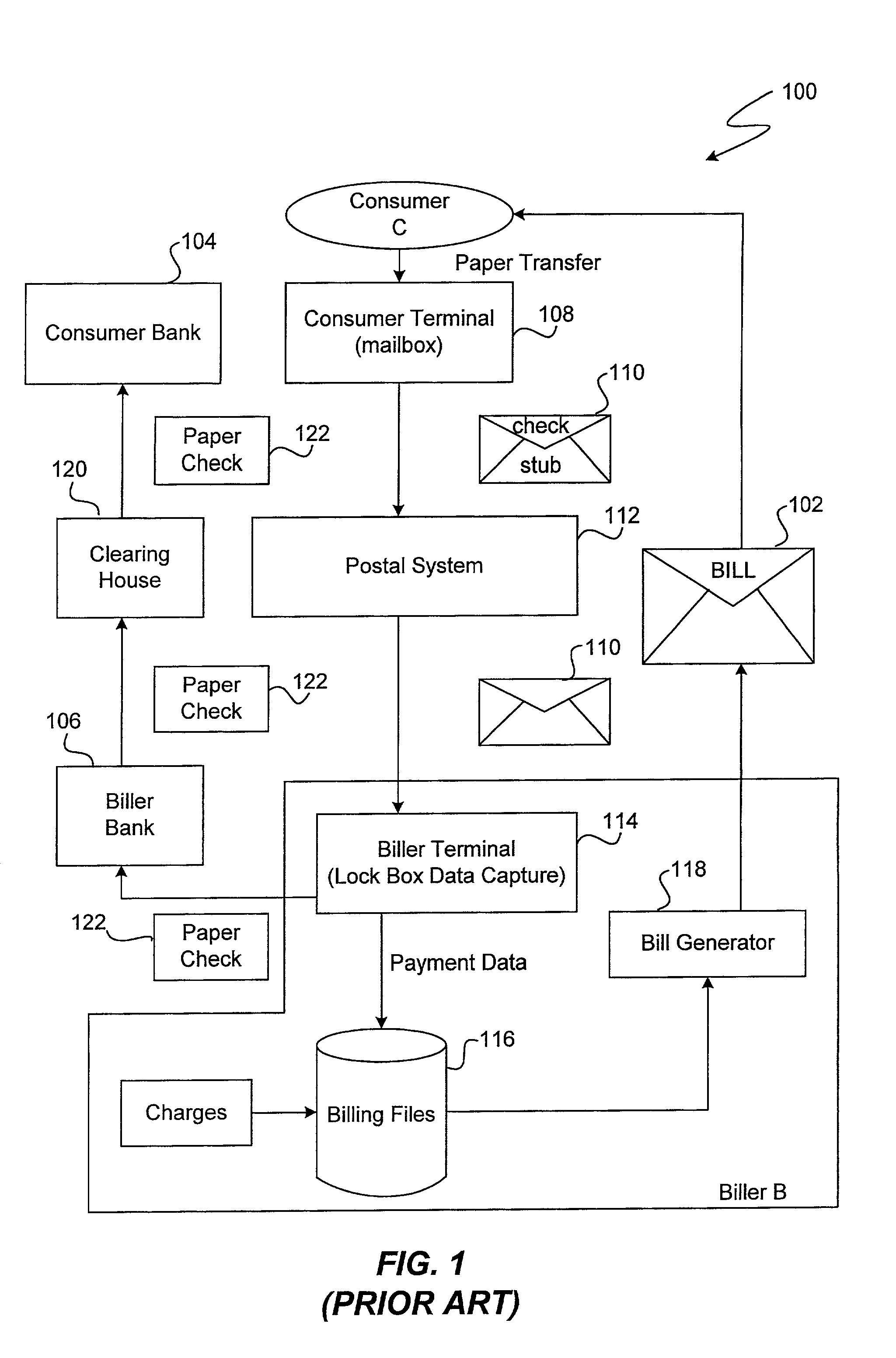

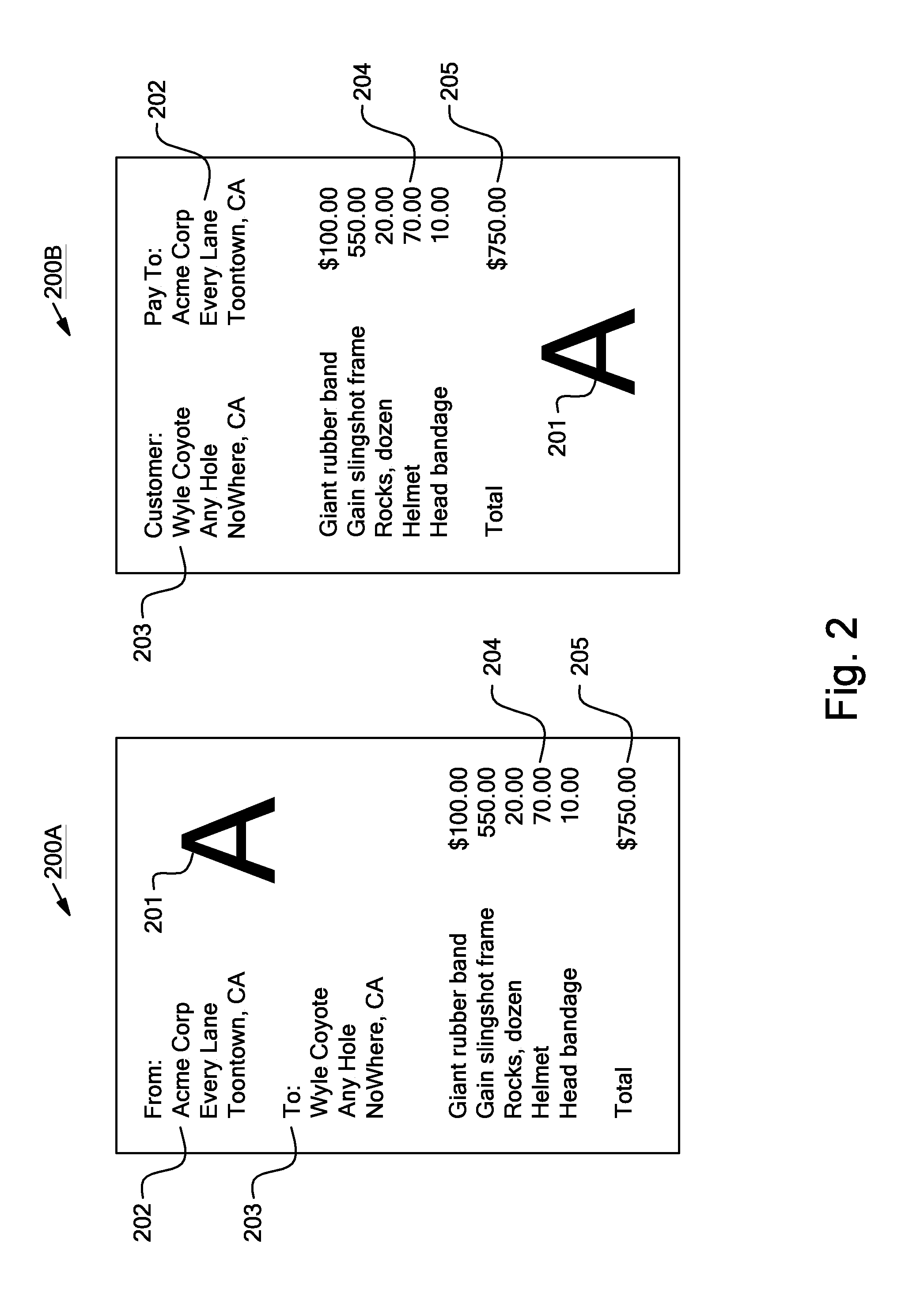

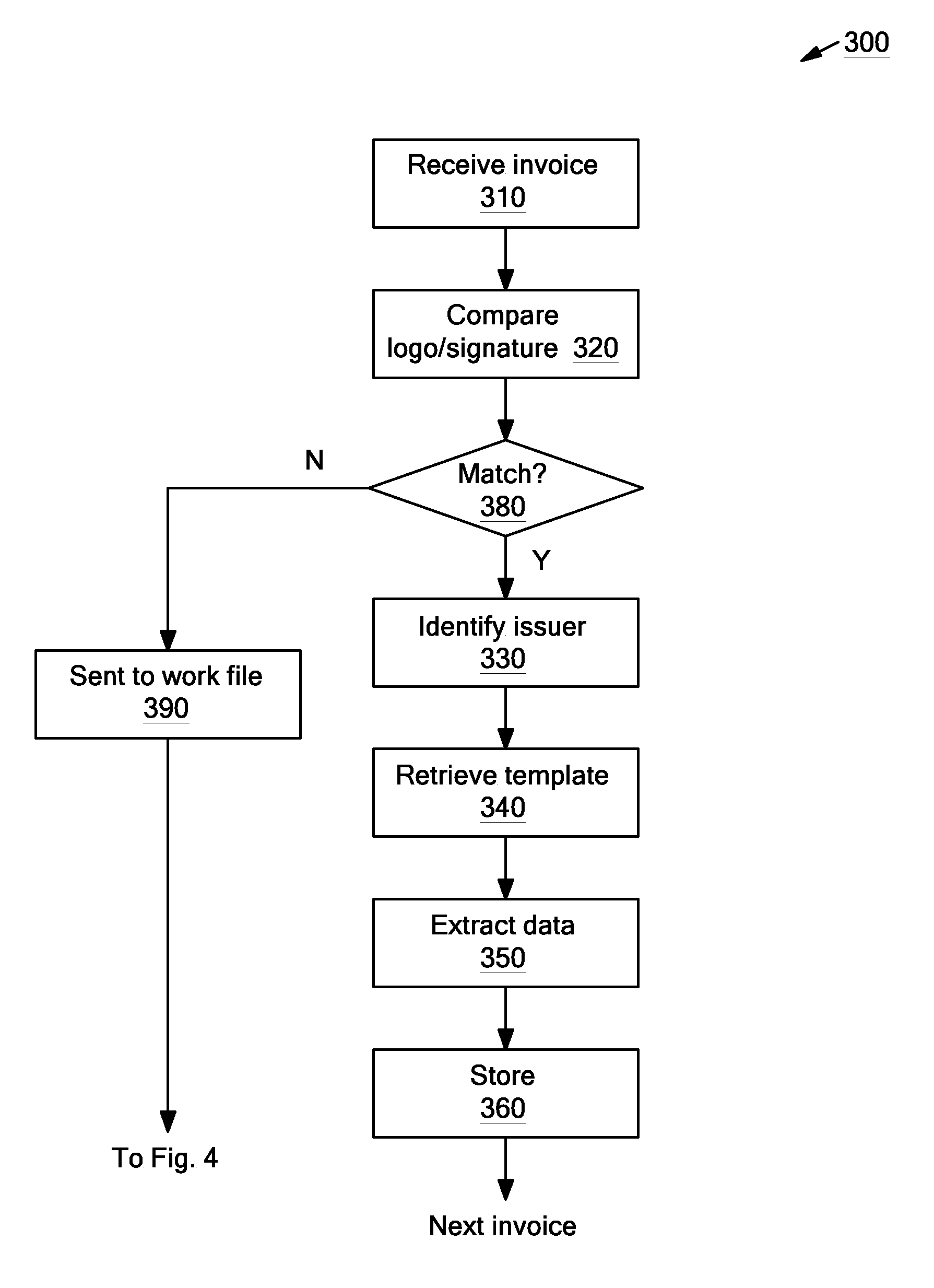

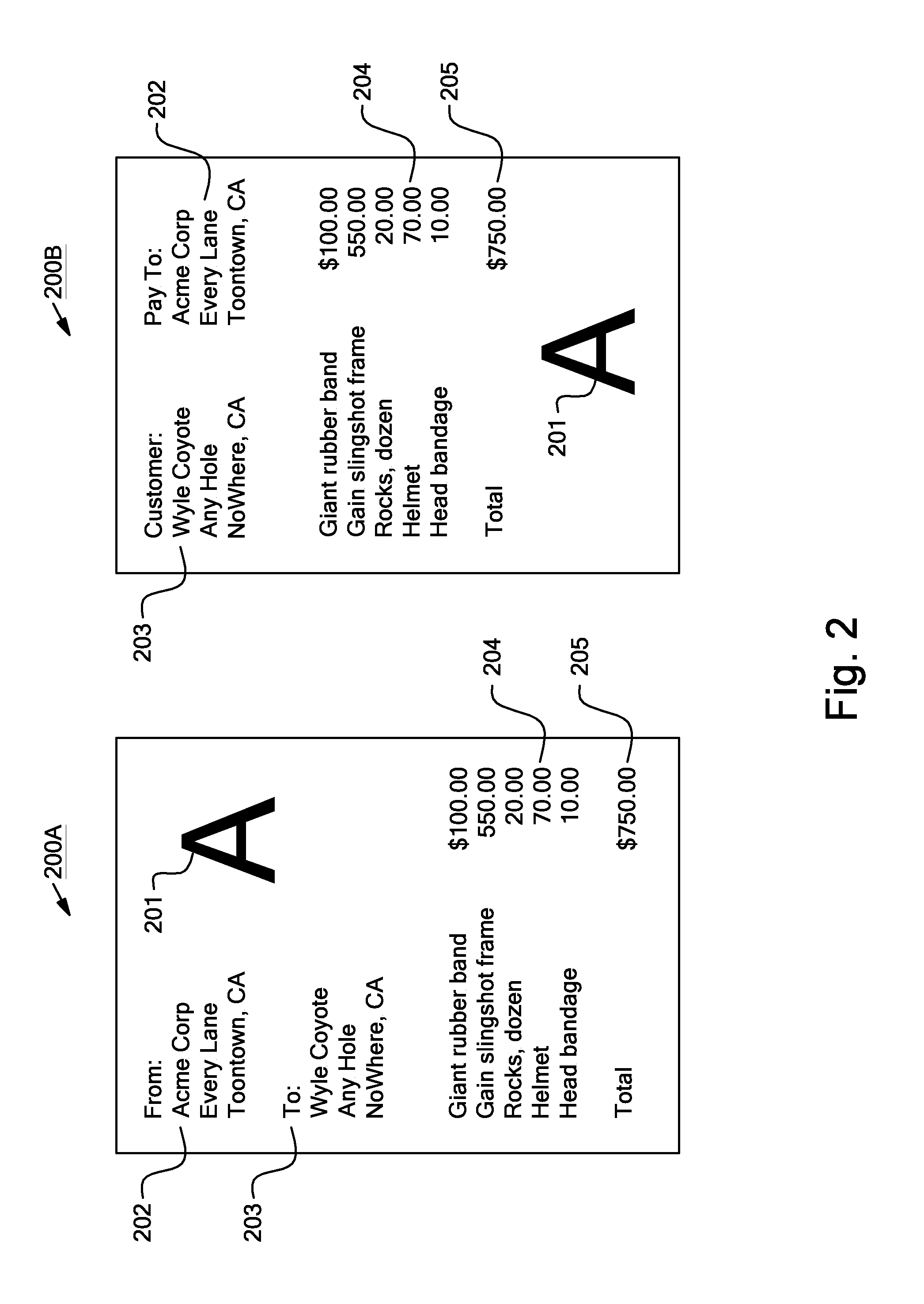

Method and apparatus for paying bills electronically using machine readable information from an invoice

Data capture which occurs at the consumer end of an electronic bill pay transaction is assisted by machine readable information in a standardized format on an invoice where the machine readable information includes biller identification and a C-B account number and the information is readable at the consumer end without prior arrangements being made specifically between the consumer and the biller. The biller identification is either a universal biller reference number or sufficient information to allow manual identification and contact with the biller. The machine readable information is an optically-readable bar code, characters in a font designed for error-free character recognition by optical or magnetic means.

Owner:VISA INT SERVICE ASSOC

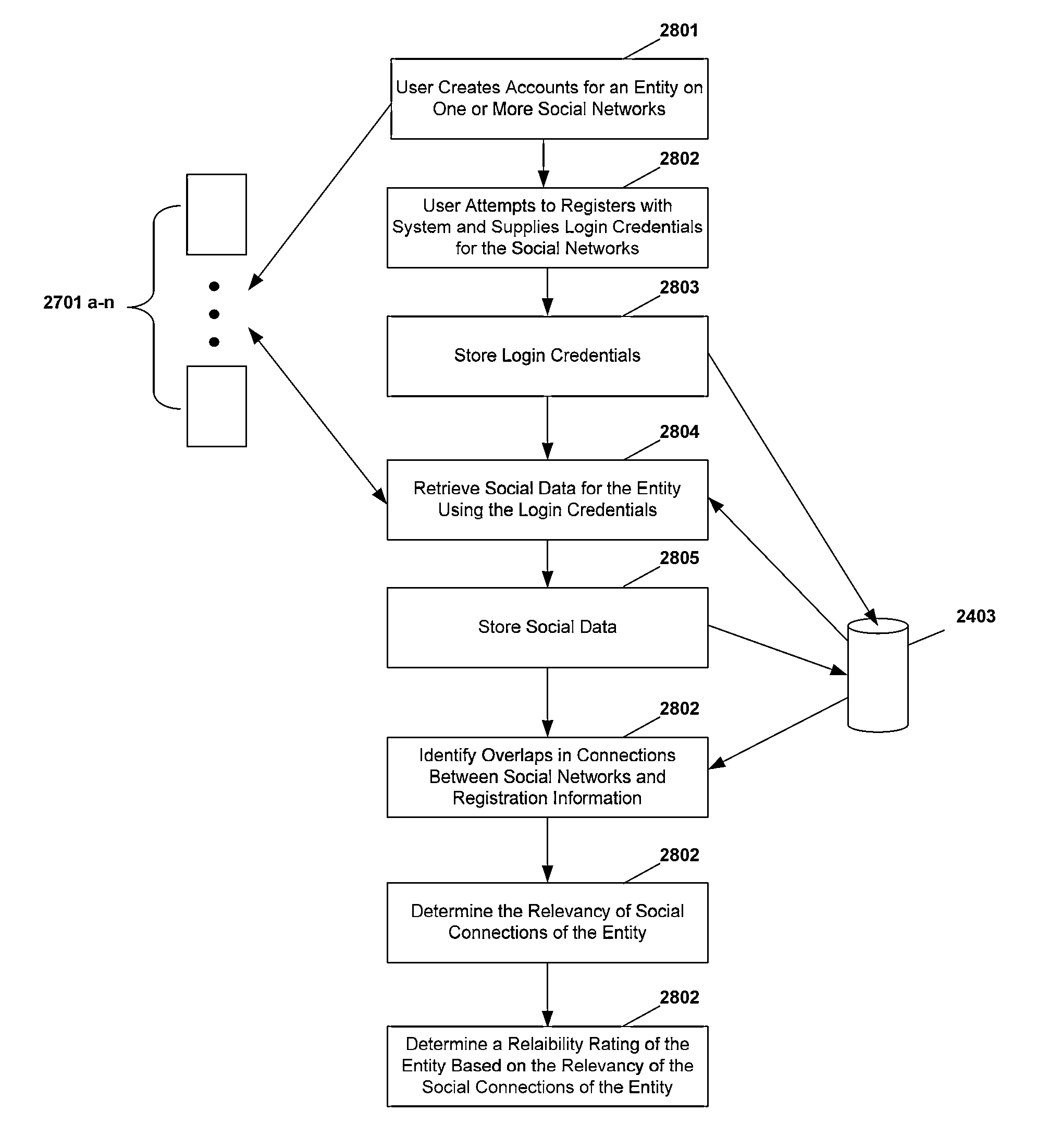

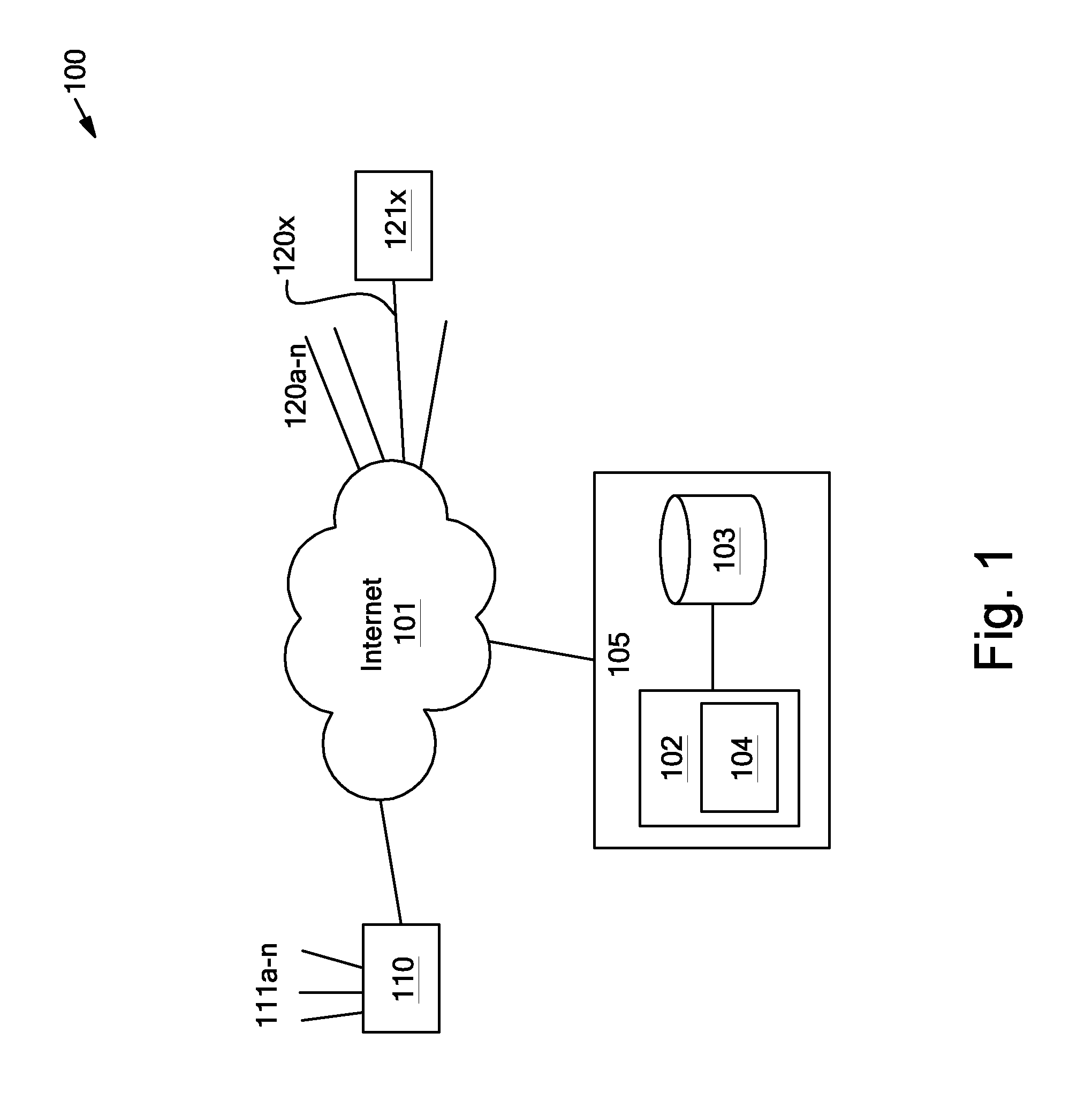

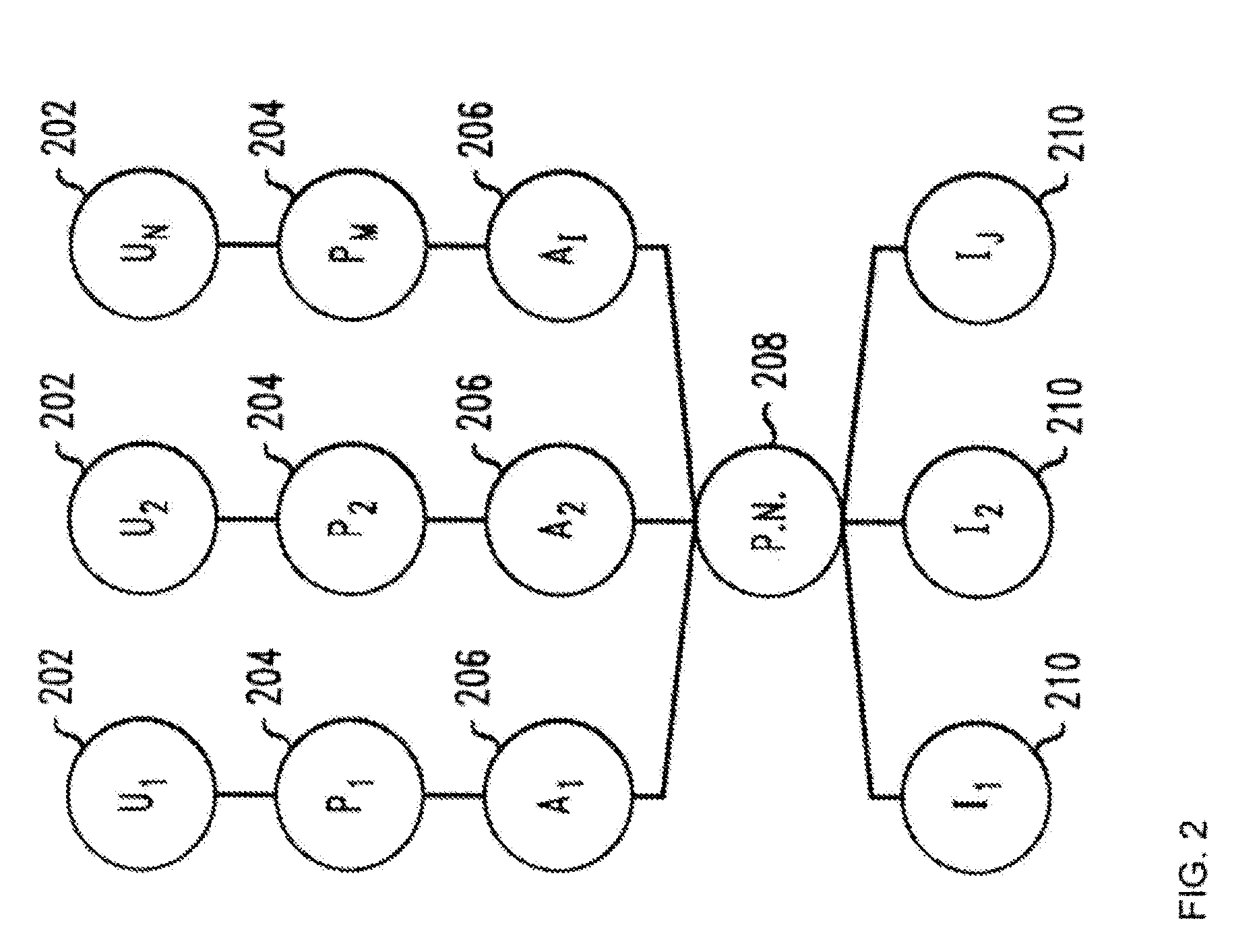

Method and system for using social networks to verify entity affiliations and identities

ActiveUS8819789B2Digital data processing detailsMultiple digital computer combinationsThird partySocial web

Login credentials for at least one website, such as a social networking website, are received from a user purporting to act on behalf of an entity, for example, in the context of registering the entity with a system for electronic bill payment. Social data relating to the entity is retrieved from the websites using the login credentials. The social data comprises a plurality of social connections, each reflecting a respective relationship between the entity and a respective third party. A plurality of relevant social connections comprising at least a subset of the plurality of social connections is determined, each social connection of the plurality of relevant social connections reflecting a relationship to a respective third party that is deemed to be reliable. A reliability rating of the entity is then determined based on the plurality of relevant social connections.

Owner:BILL OPERATIONS LLC

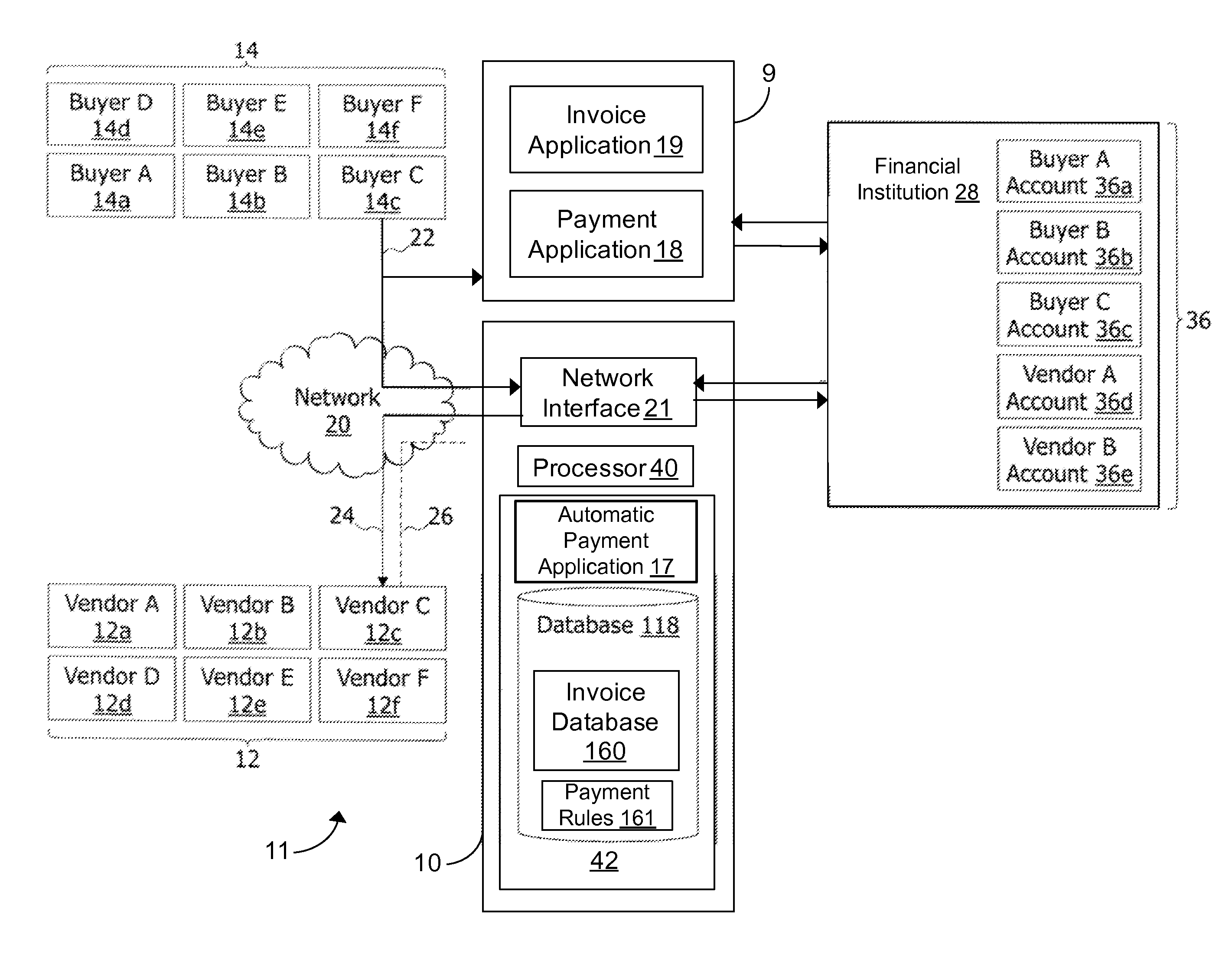

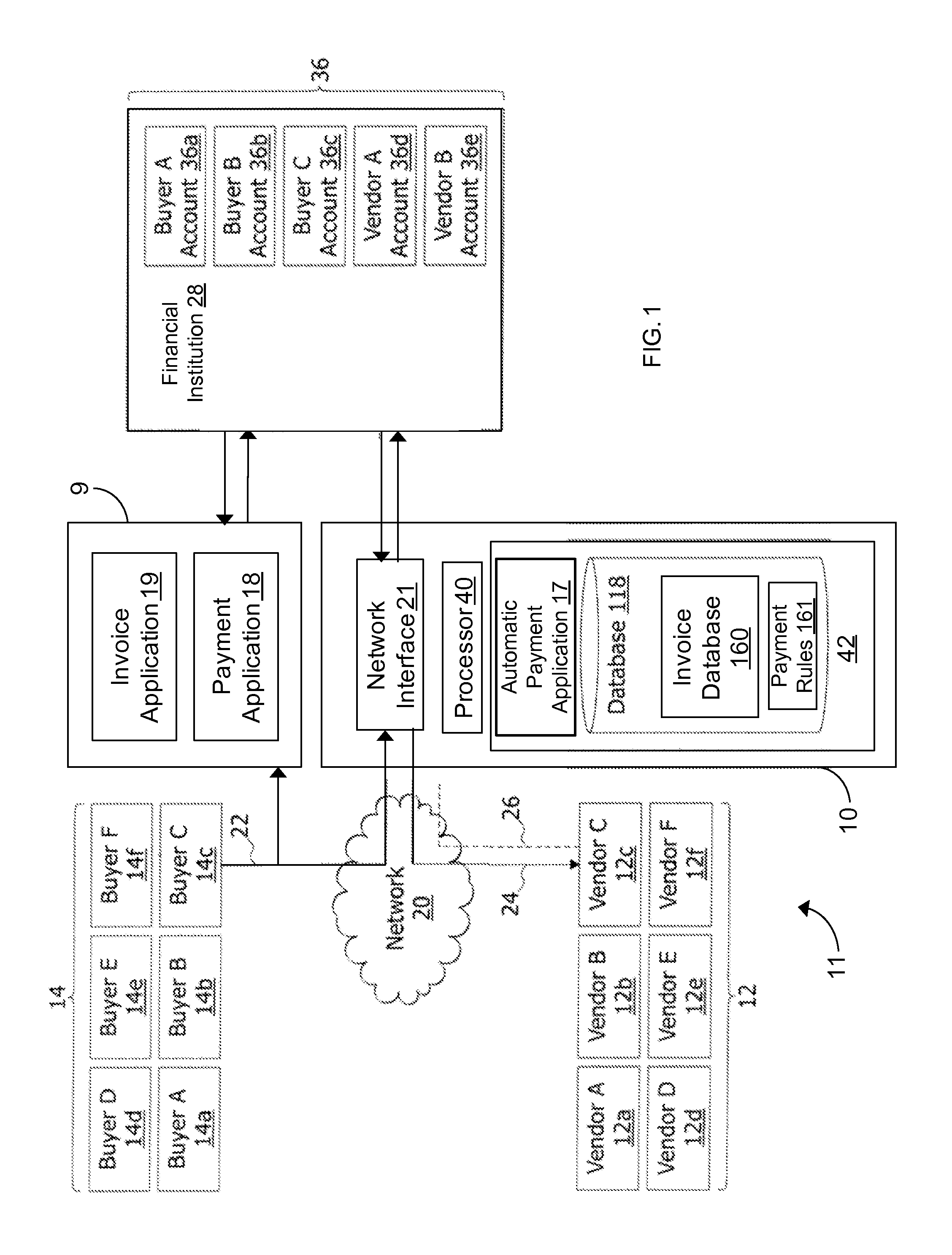

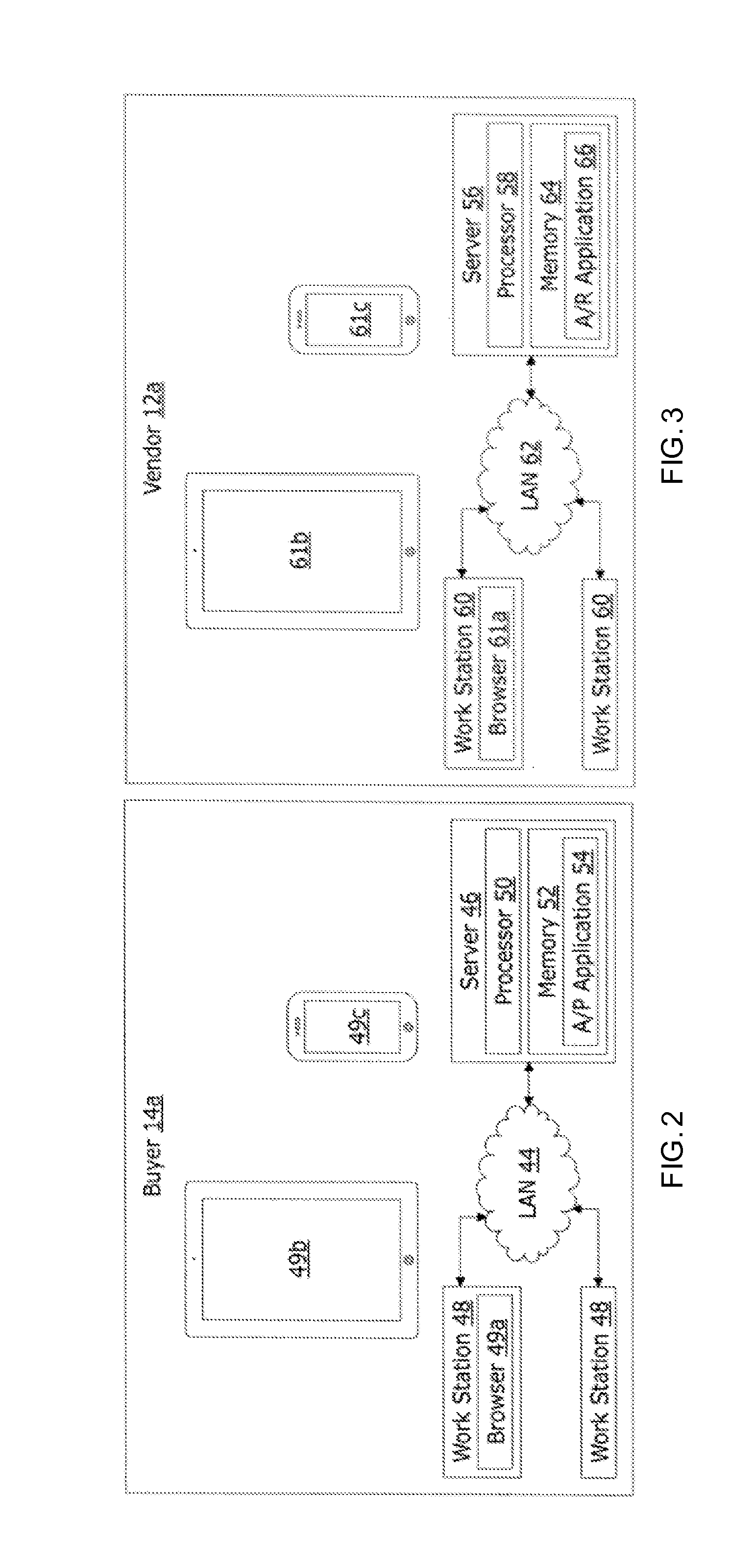

Automatic payment component for an electronic invoice payment system

An automatic invoice payment system includes a database stored on a non-transitory computer readable medium, the database including a plurality of records, each record corresponding to an invoice issued by a vendor for payment from a buyer. A network interface is configured to receive presented invoices from multiple vendors for payment by multiple buyers, wherein the presented invoices are stored in the database. The processor is configured to analyze each invoice that has been presented to determine whether the presented invoice satisfies one or more predetermined rules, and when the processor determines that the presented invoice satisfies the one or more predetermined rules, to automatically set a payment initiation date upon which payment of the presented invoice is to be automatically initiated. The processor may be configured to perform such operations by the execution of an automatic payment application stored on the non-transitory computer readable medium.

Owner:BOTTOMLINE TECH

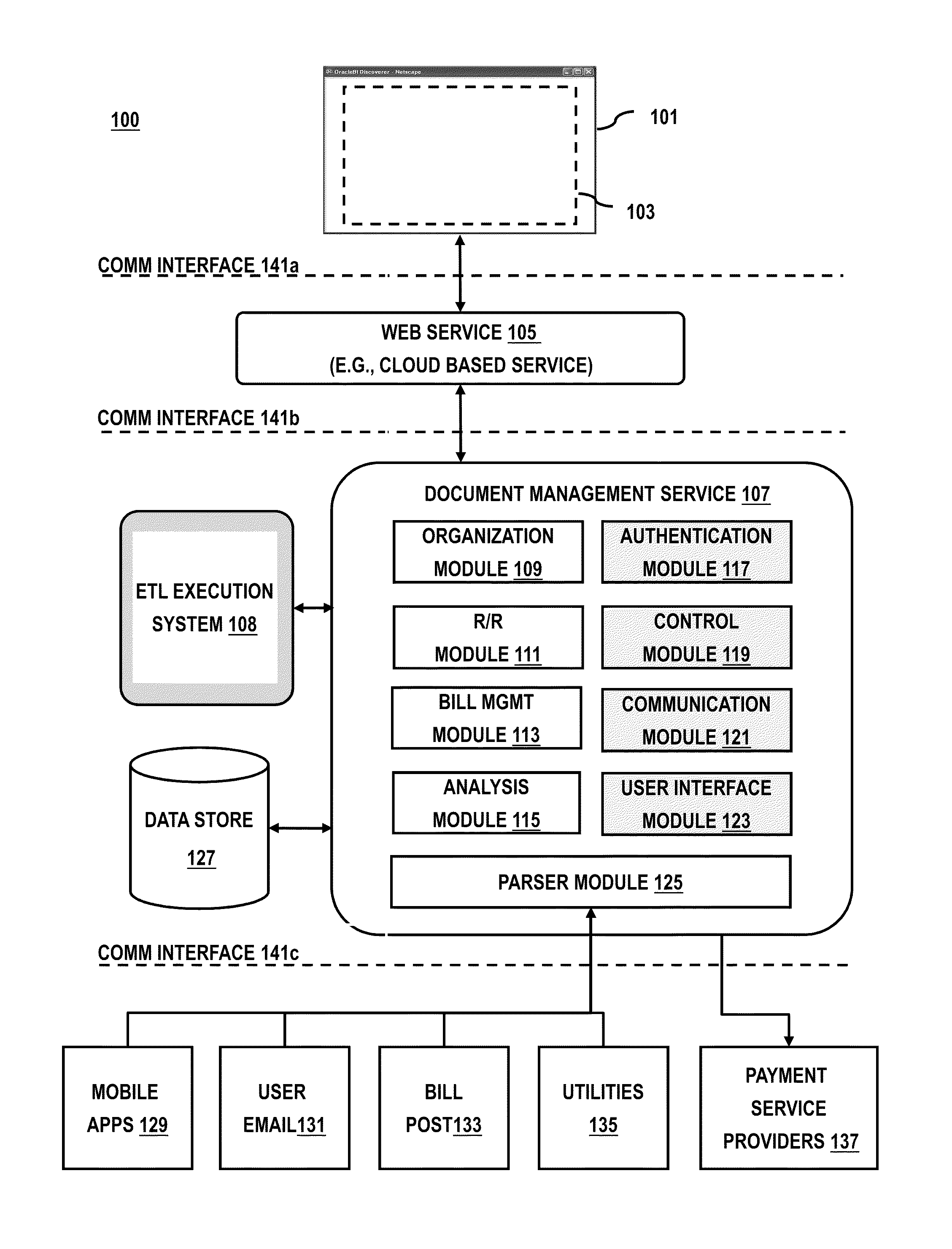

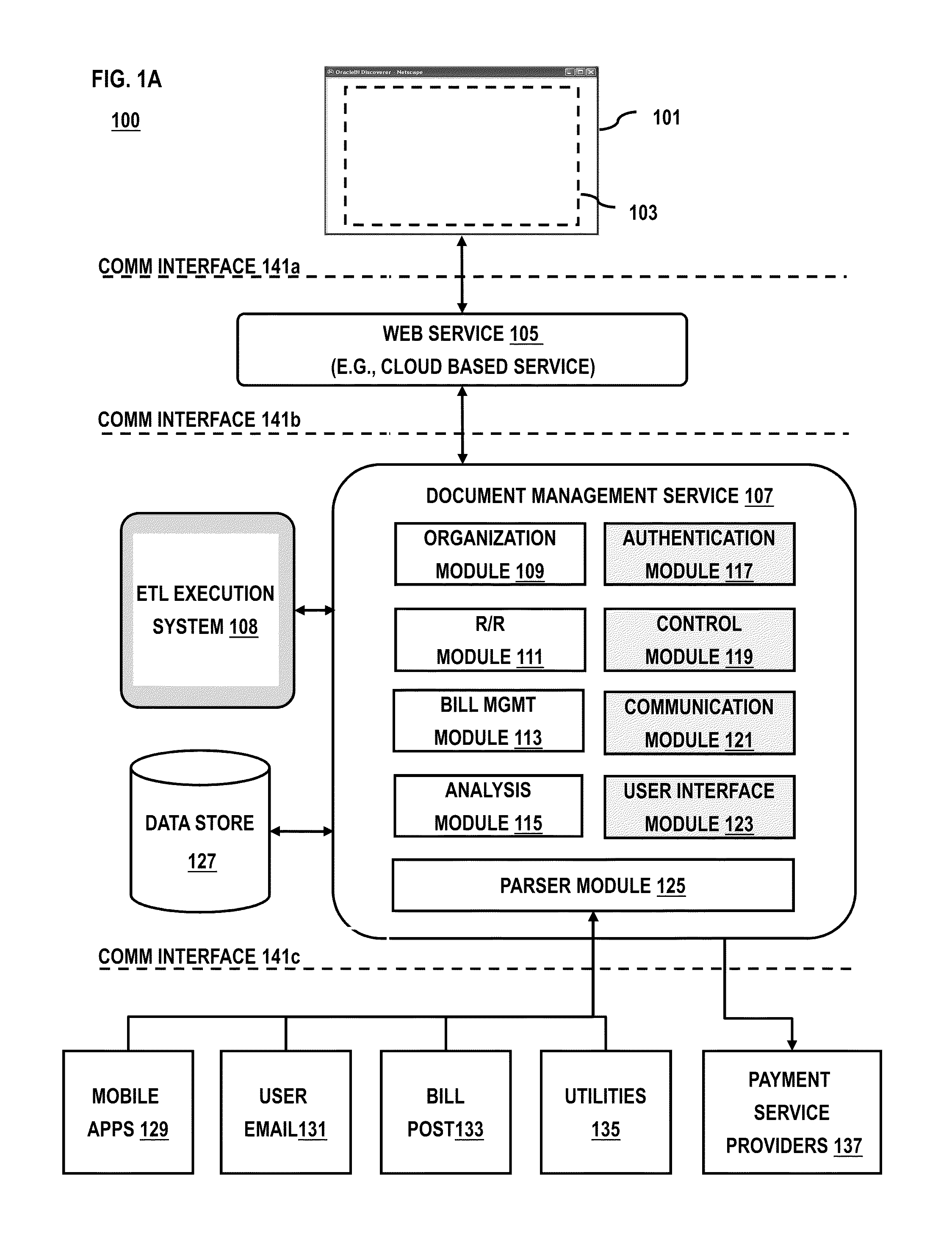

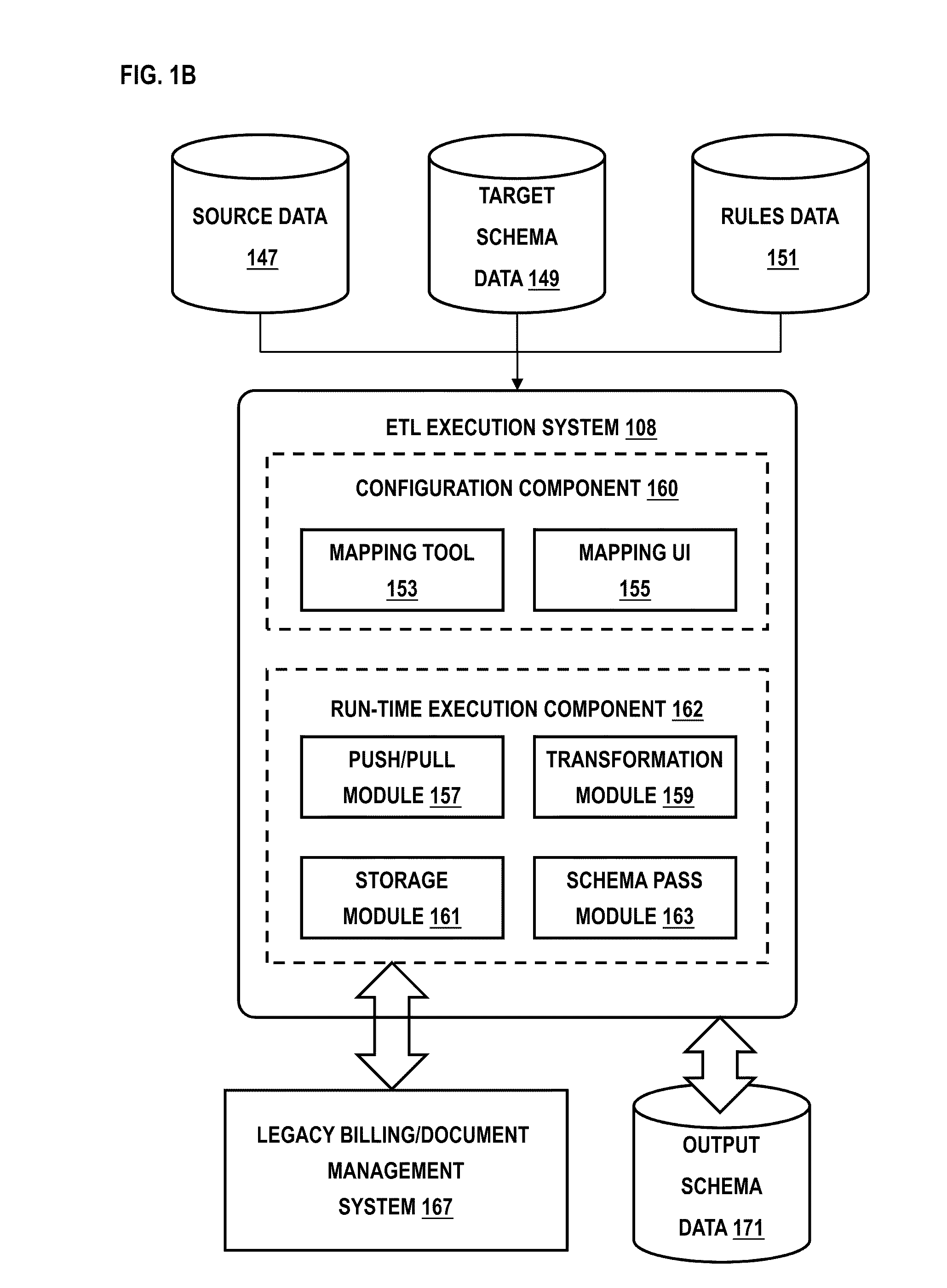

Smart on-line filing system

An approach is provided for enabling the assembly and delivery of documents for facilitating electronic bill payment and online document management. Collection of document information associated with a user account is performed, e.g., via a browser application. For example, the document information can include a digital scan of a physical document or an image. The collected document information is stored in a cloud-based filing system, which is configured to store a multitude of document information for respective user accounts. One or more actions are selectively initiated based on the collected document information for the particular user account.

Owner:BRITEBILL

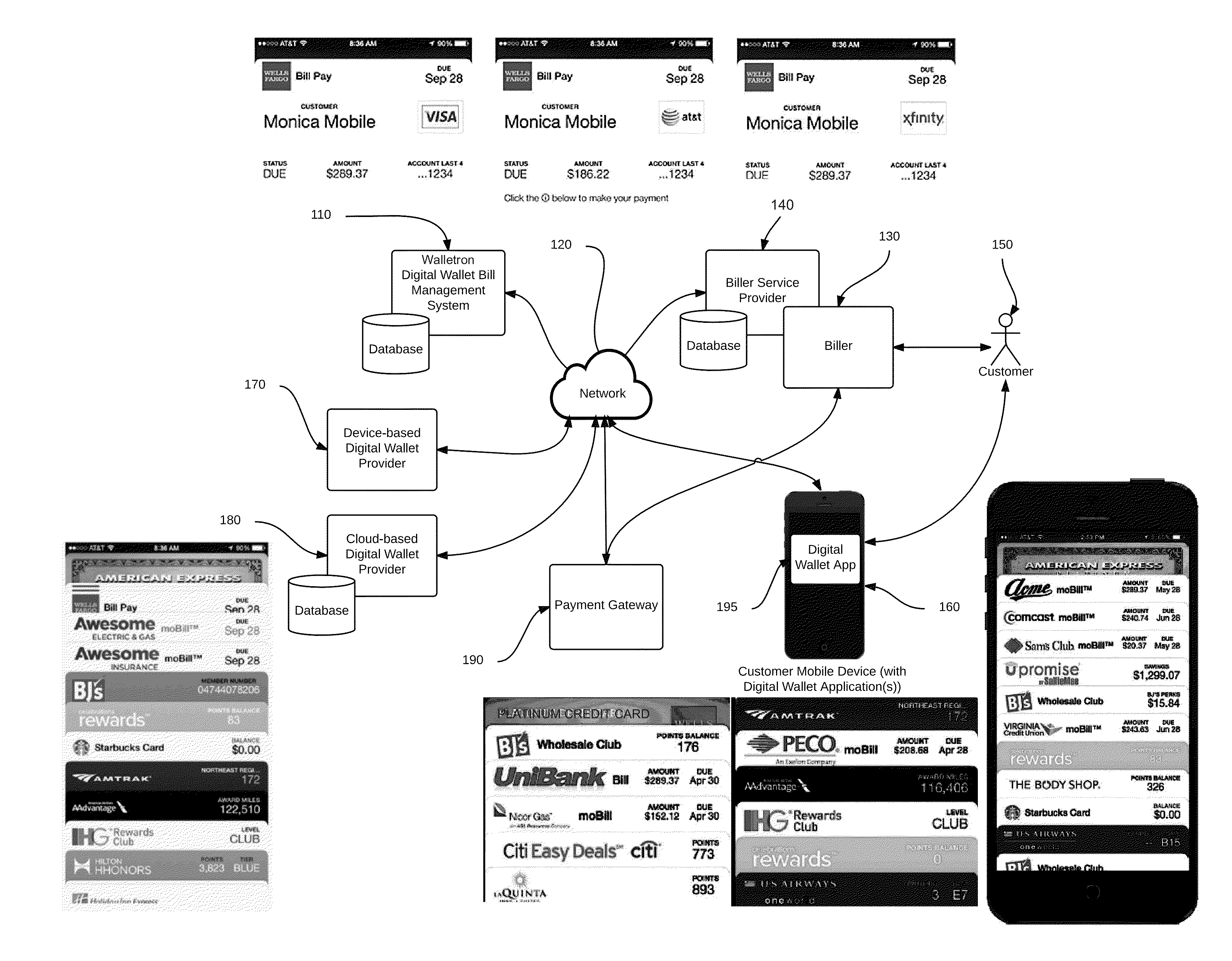

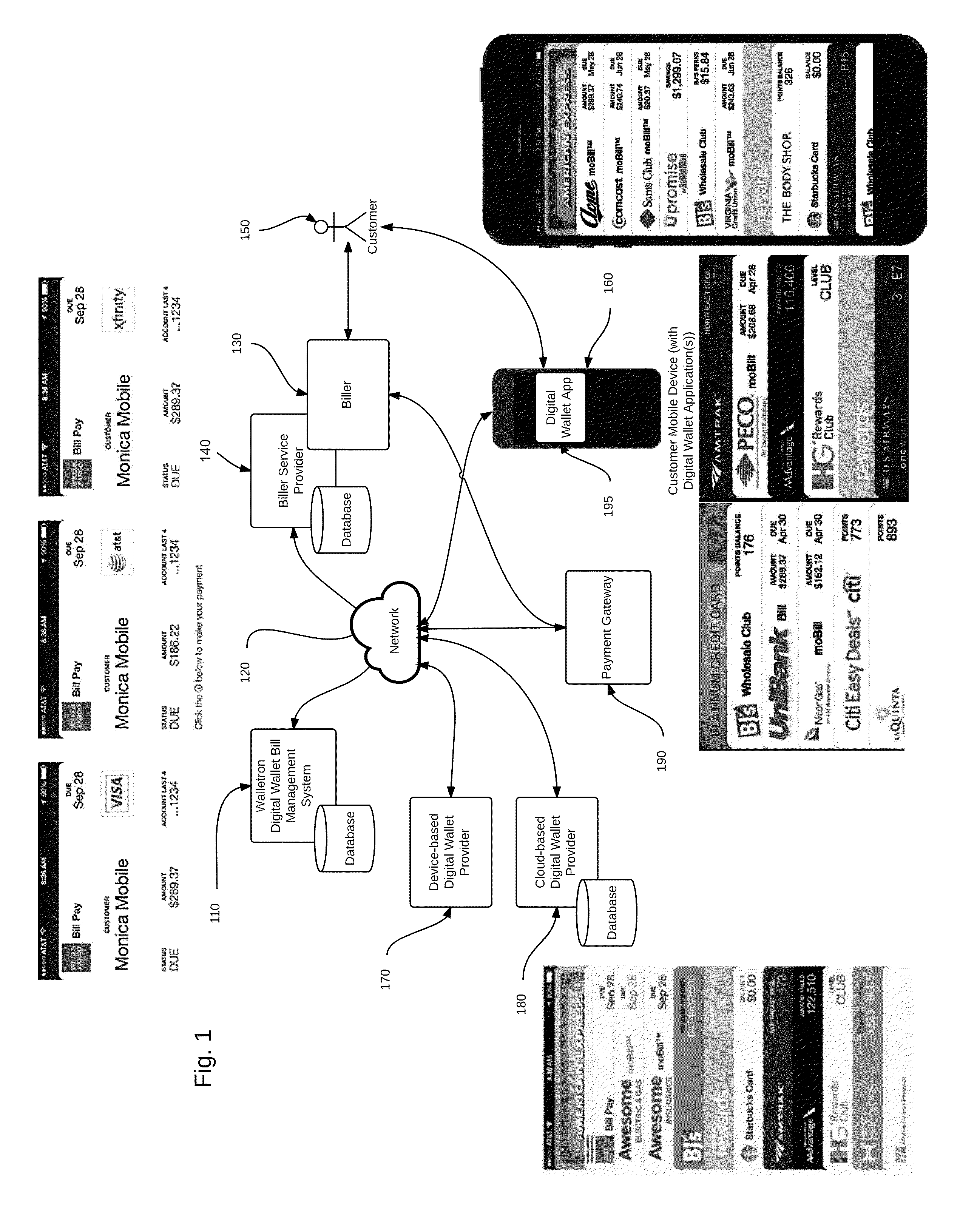

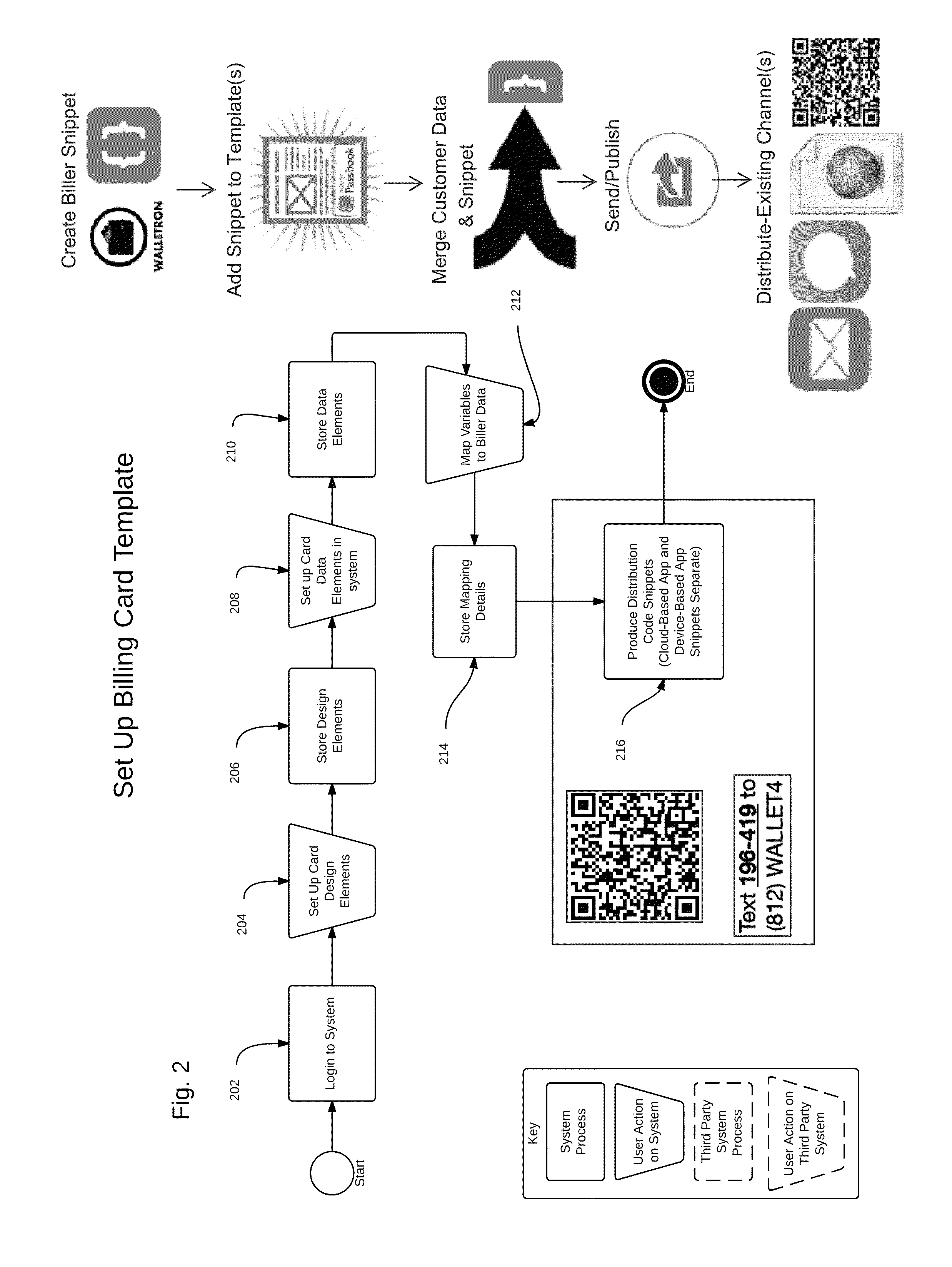

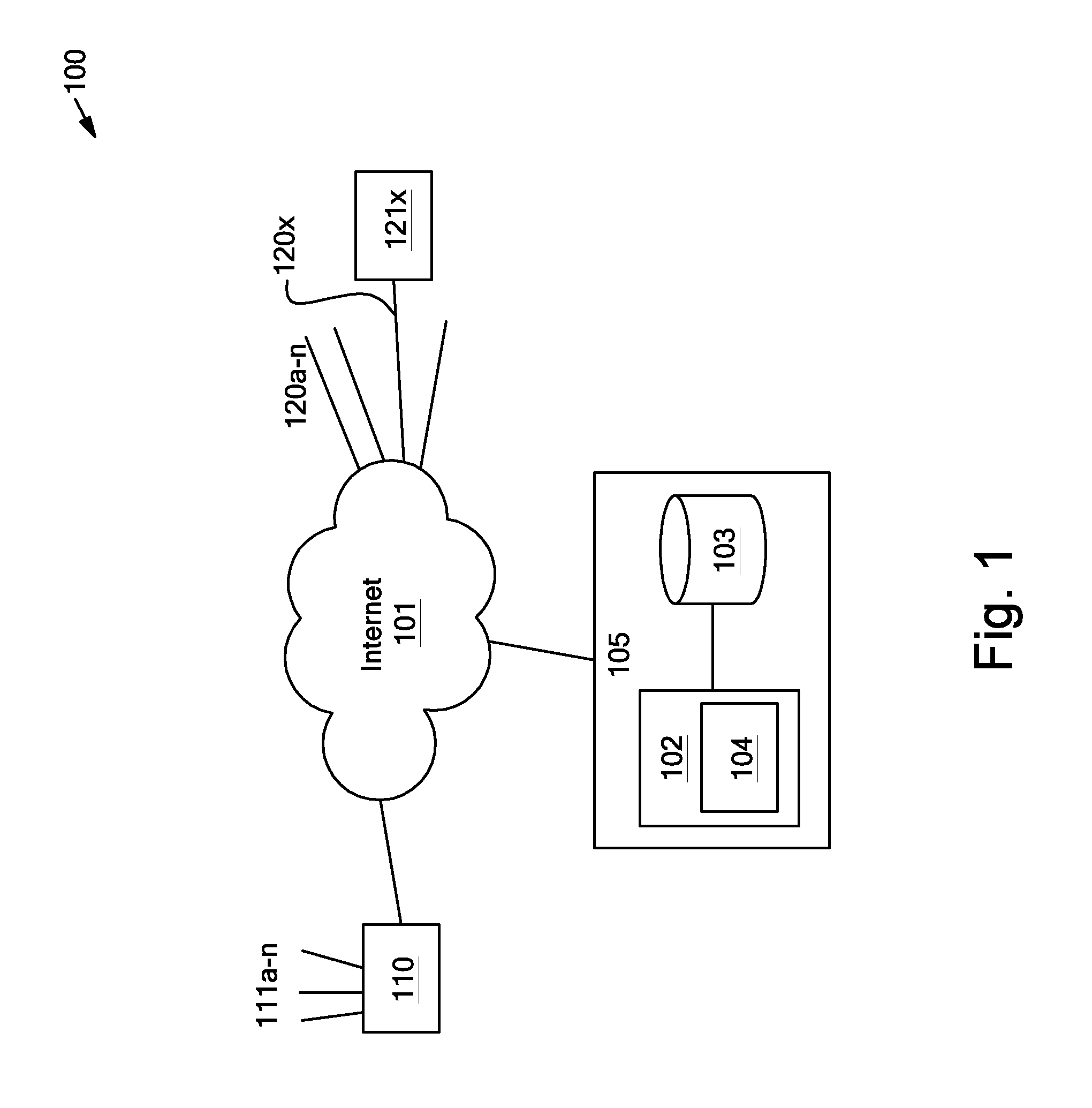

System and method for administering billing, servicing messaging and payment in digital wallets

A digital wallet bill management system runs on centralized processors in operative communication with databases and in networked communication with digital wallet applications, computerized billing systems and payment gateways. Code snippet activators are provided to customers running digital wallet applications on their respective electronic devices. When customers activate the code snippet information, the digital wallet bill management system produces biller e-cards for the digital wallet applications, linking customer accounts to the billing system for the respective customers. The code snippets include biller codes, customer codes and URL addresses, and the system matches the codes with data stored in the database for the respective biller and customer and transmits the biller e-card information to the respective electronic devices for the digital wallet application. The customers use funding e-cards in their digital wallets to produce electronic bill payment records for electronic bills that the system populates using the biller e-cards.

Owner:ACI WORLDWIDE

Method and system for using social networks to verify entity affiliations and identities

ActiveUS20130239185A1Digital data processing detailsMultiple digital computer combinationsThird partySocial media network

Login credentials for at least one website, such as a social networking website, are received from a user purporting to act on behalf of an entity, for example, in the context of registering the entity with a system for electronic bill payment. Social data relating to the entity is retrieved from the websites using the login credentials. The social data comprises a plurality of social connections, each reflecting a respective relationship between the entity and a respective third party. A plurality of relevant social connections comprising at least a subset of the plurality of social connections is determined, each social connection of the plurality of relevant social connections reflecting a relationship to a respective third party that is deemed to be reliable. A reliability rating of the entity is then determined based on the plurality of relevant social connections.

Owner:BILL COM LLC

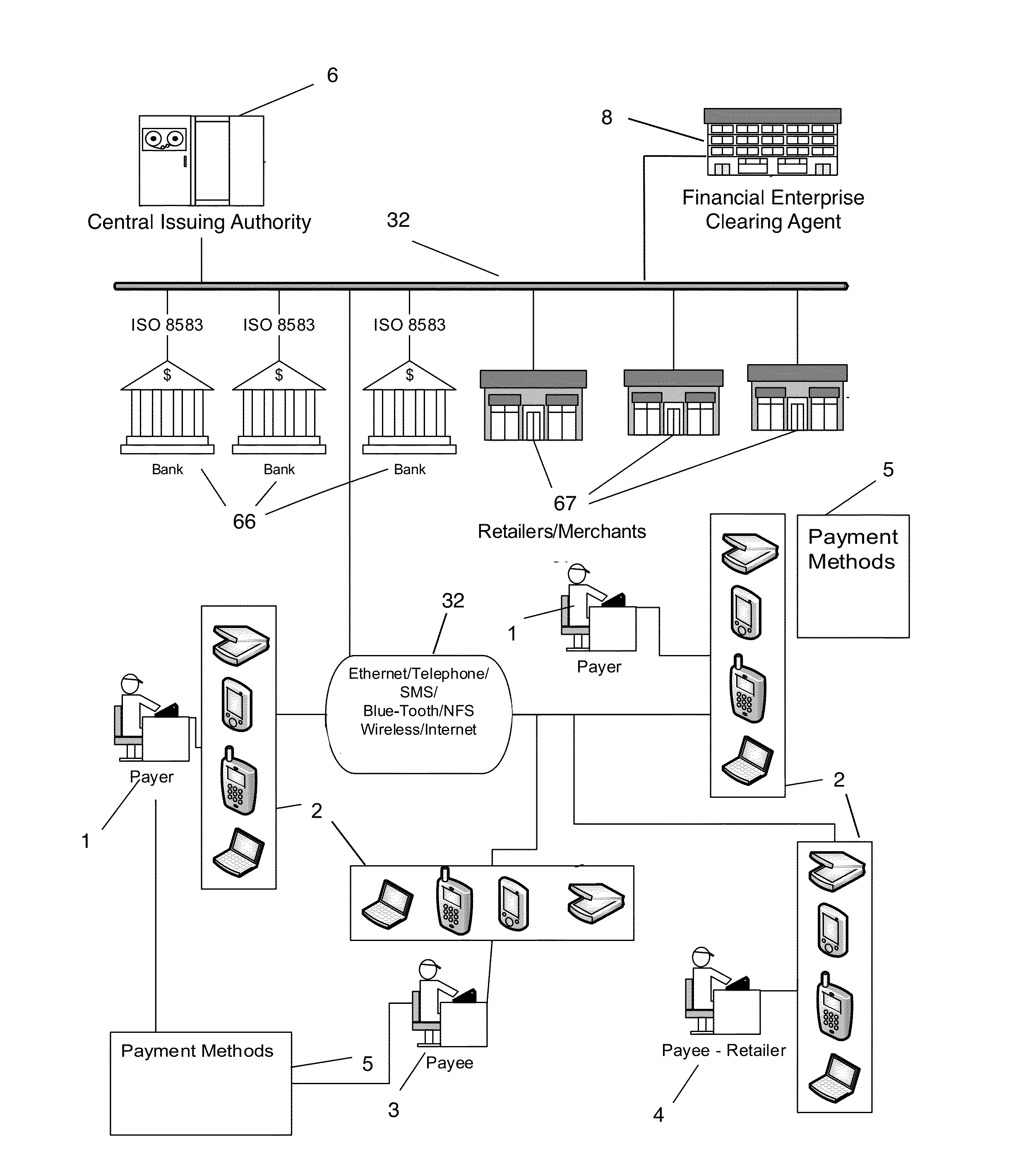

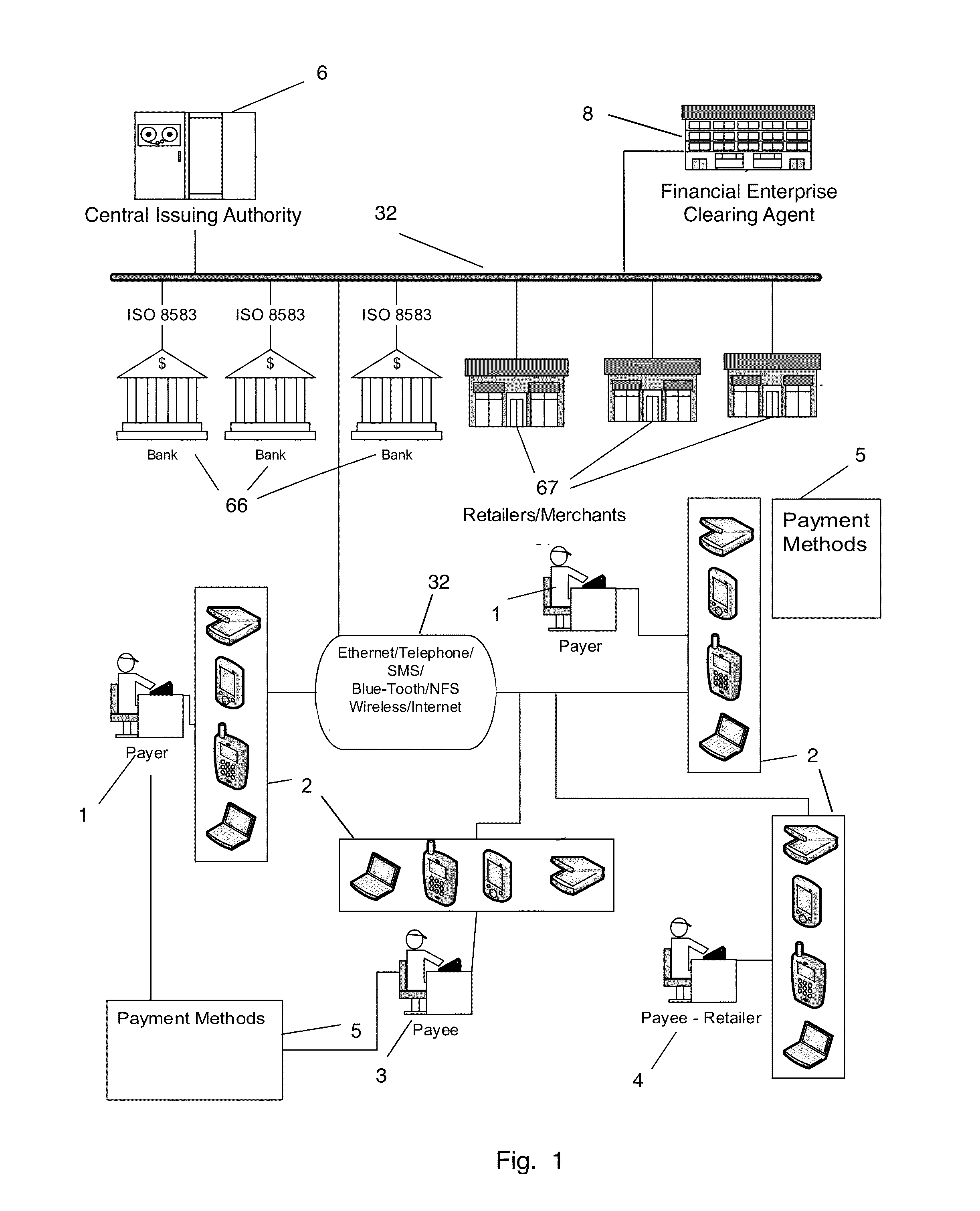

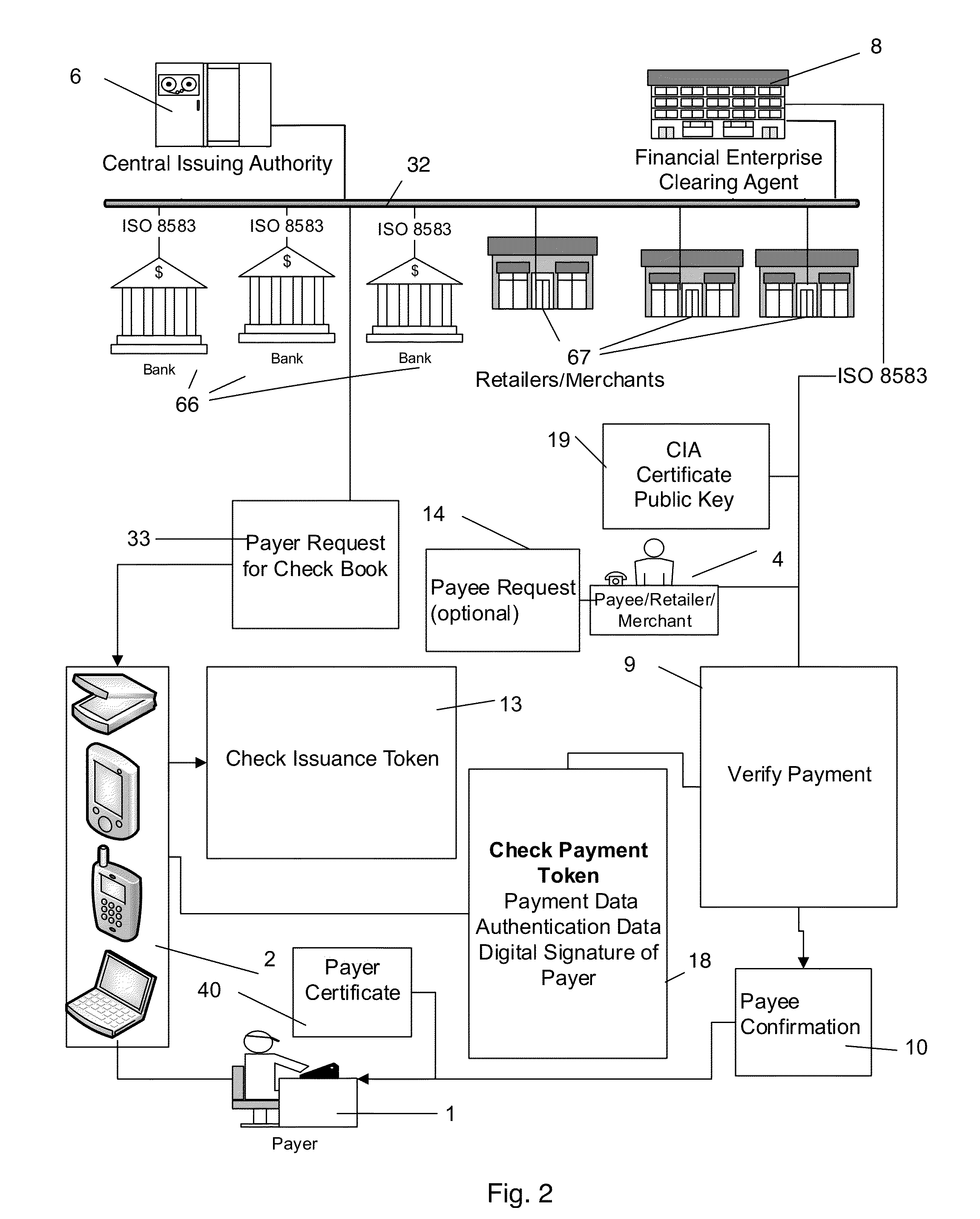

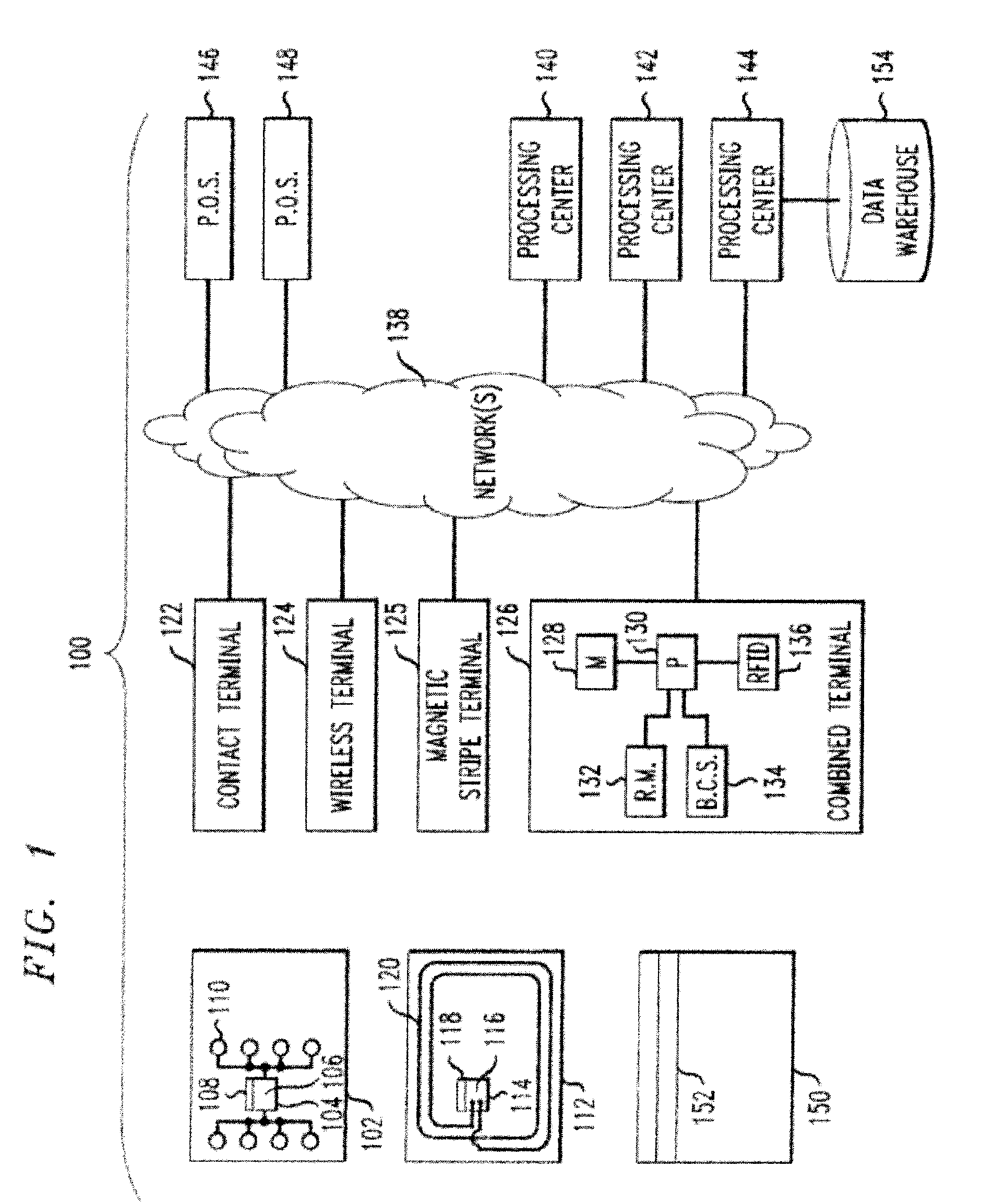

Electronic payment and authentication system

InactiveUS20150120536A1Enhance wireless paymentBetter user identificationFinancePayment protocolsChequeAuthentication system

The invention relates to electronic currency transactions, facilitated by electronic equivalents of checks and credit / debit cards. The electronic equivalents are encrypted tokens, which are data units suitable for storage in and transfer between participants' data storage devices. The invention provides an electronic payment system having Check- and Card-Issuing Authorities that are coupled to a token-generating server. Electronic checks and credit / debit cards, backed by correspondent Check- and Card-Issuing Authorities, are generated and issued to subscribing customers as issuance tokens. A plurality of token-generating devices are used by participants to generate payment tokens authorized by the issuance tokens, and to perform electronic check and card transactions by exchanging tokens with other participants and participating Financial Institutions. The invention provides methods for authentication and verification of the token data, for maintaining the integrity of the system, and for detecting and preventing counterfeiting and tampering within the system.

Owner:TALKER ALBERT

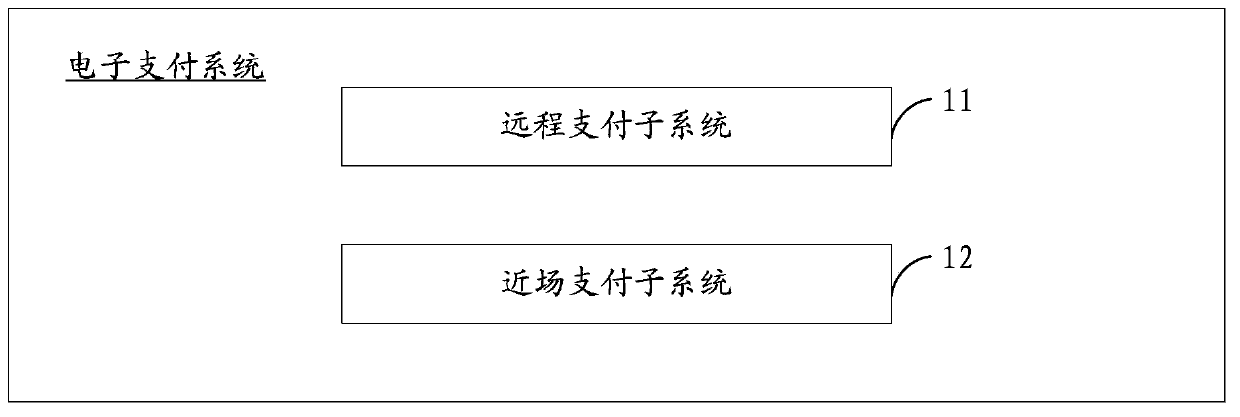

Electronic payment system and remote-based or near-field-based payment method

InactiveCN103426084AGuarantee authenticityImprove confidentialityCash registersProtocol authorisationPasswordComputer terminal

The invention relates to an electronic payment system and a remote-based or near-field-based payment method. The electronic payment system comprises a remote payment subsystem and a near-field payment subsystem, each of the subsystem comprises a payment card, a payment terminal, a collection card, a collection terminal, a payment server and a collection server. According to the remote-based payment method, remote payment can be achieved through a bound remote payment account, the payment terminal, the payment card and payment passwords, remote payment collection can be achieved through a bound remote collection account, the collection terminal and the collection card, and the payment server receives payment amount and the payment passwords. According to the near-field-based payment method, near-field payment can be achieved through a bound near-field payment account, the payment terminal and the payment card, near-field payment collection can be achieved through a bound near-field collection account, the collection terminal and the collection card, the payment information of the payment terminal and the payment information of the payment card are mutually backed up, and the collection information of the collection terminal and the collection information of the collection card are mutually backed up.

Owner:牟大同

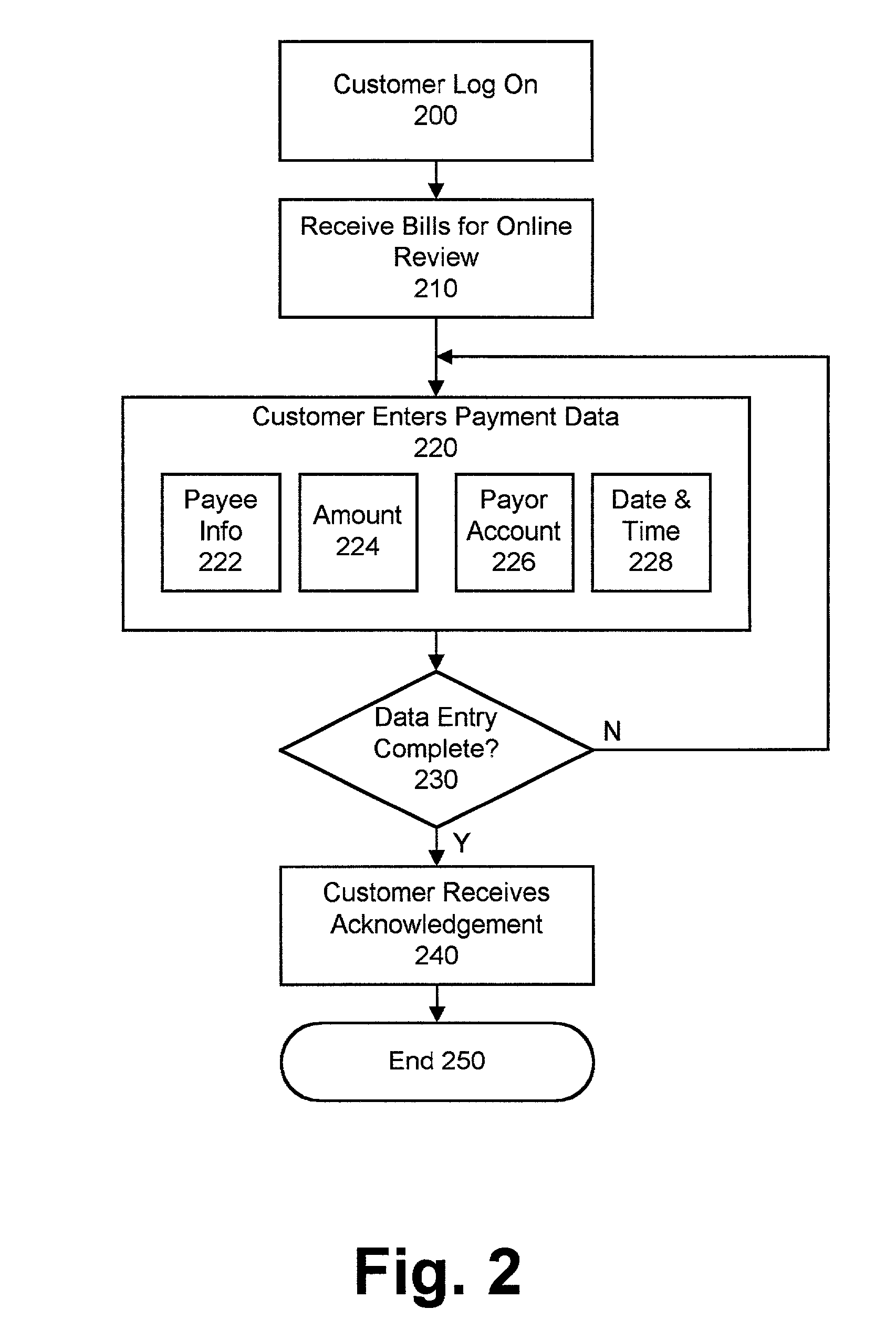

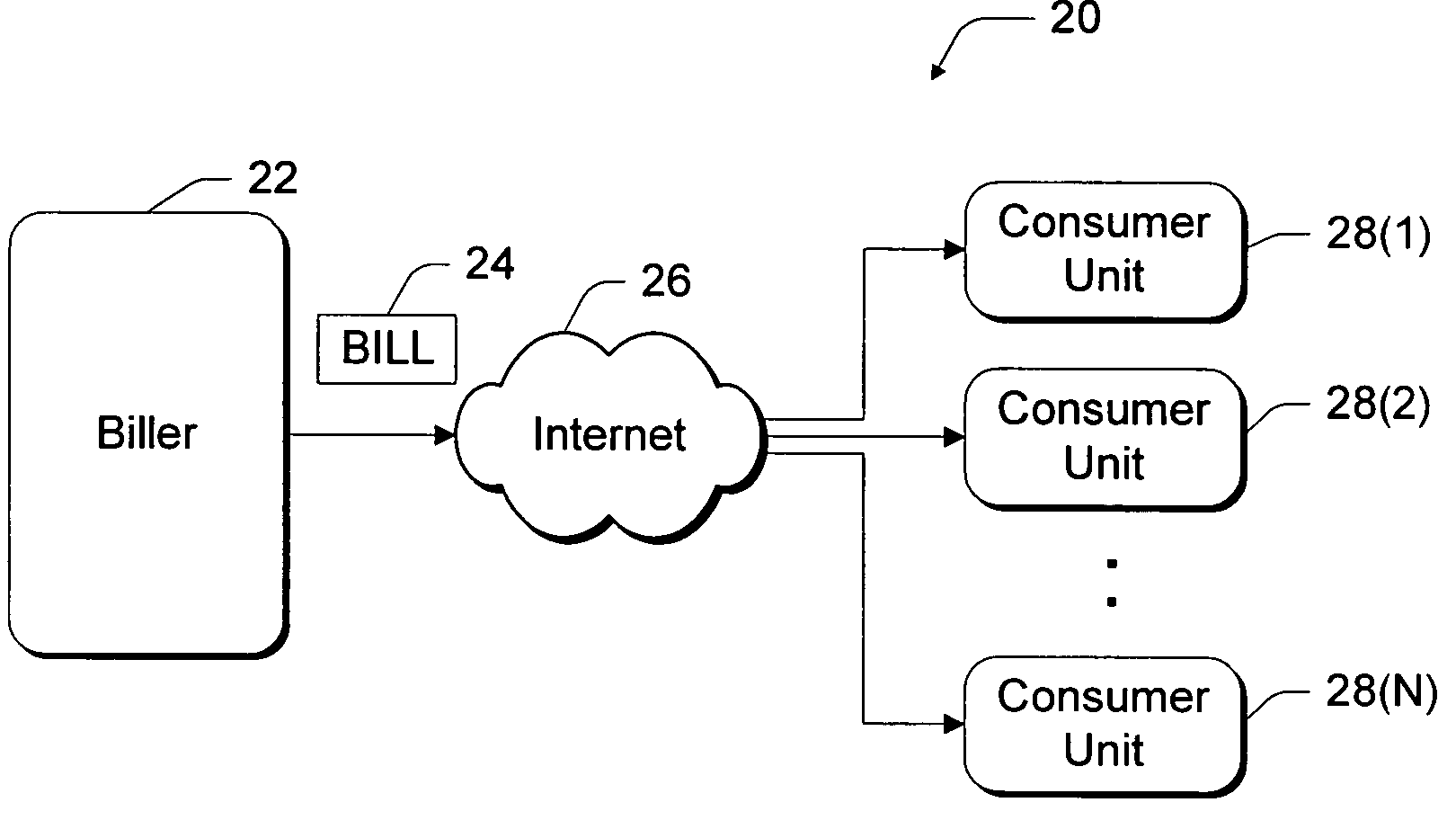

System and method for electronic bill pay and presentment

A system and method is disclosed enabling a customer payor to make payment to a payee in a networked environment using a credit card, revolving credit, or other credit account. The payment system may provide for online receipt and review of bills, and may allow a customer payor to optionally select one or more alternative secondary accounts for payment in the event that payment cannot be made from a primary credit account. The secondary account may be another credit account, a checking account, a brokerage account, or another type of account. Actual payment may be accomplished by electronic settlement of a credit transaction, electronic funds transfer, or by printing and physically delivering a paper check. A customer payor using the system and method may receive notification concerning the success or failure of the transaction.

Owner:JPMORGAN CHASE BANK NA +1

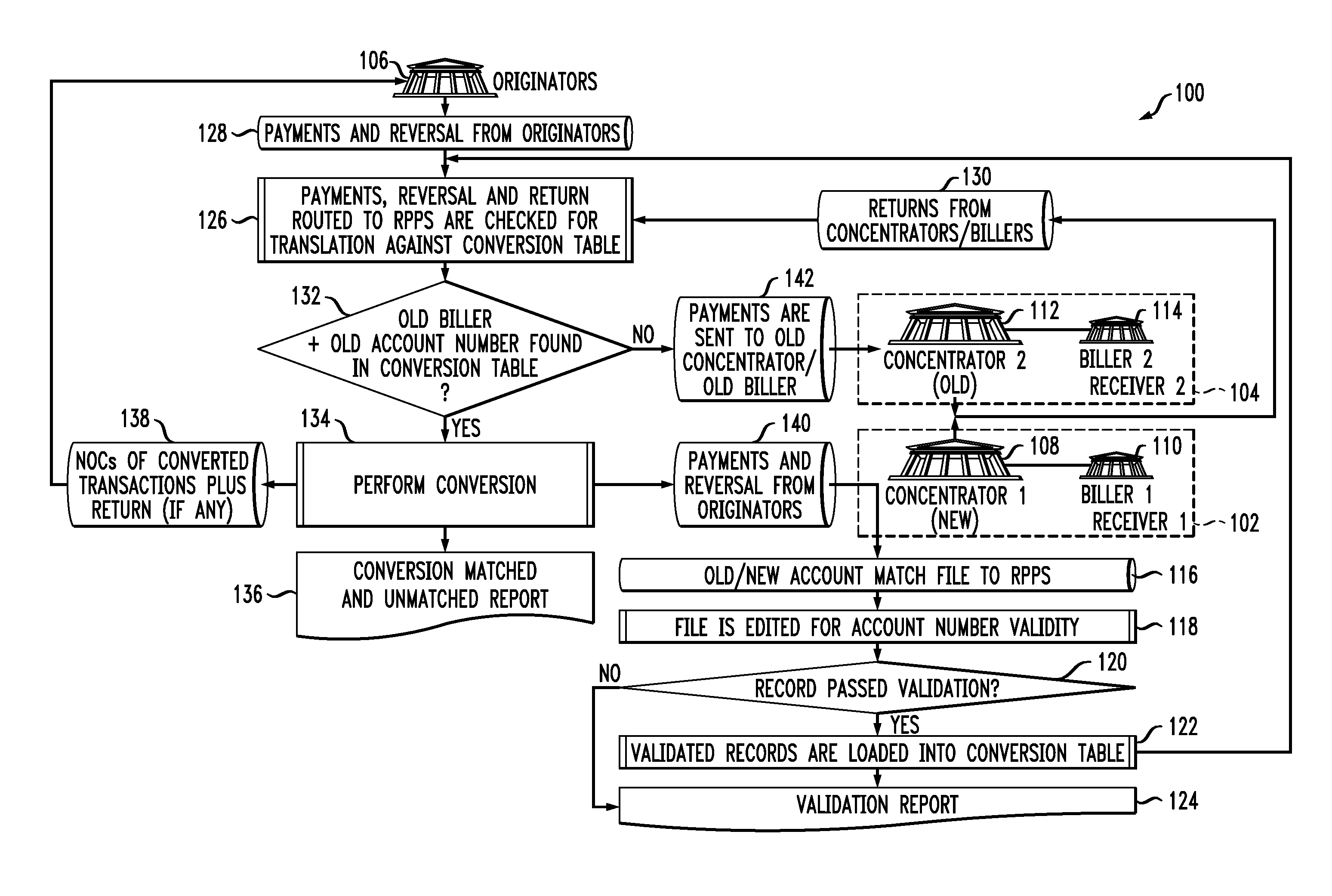

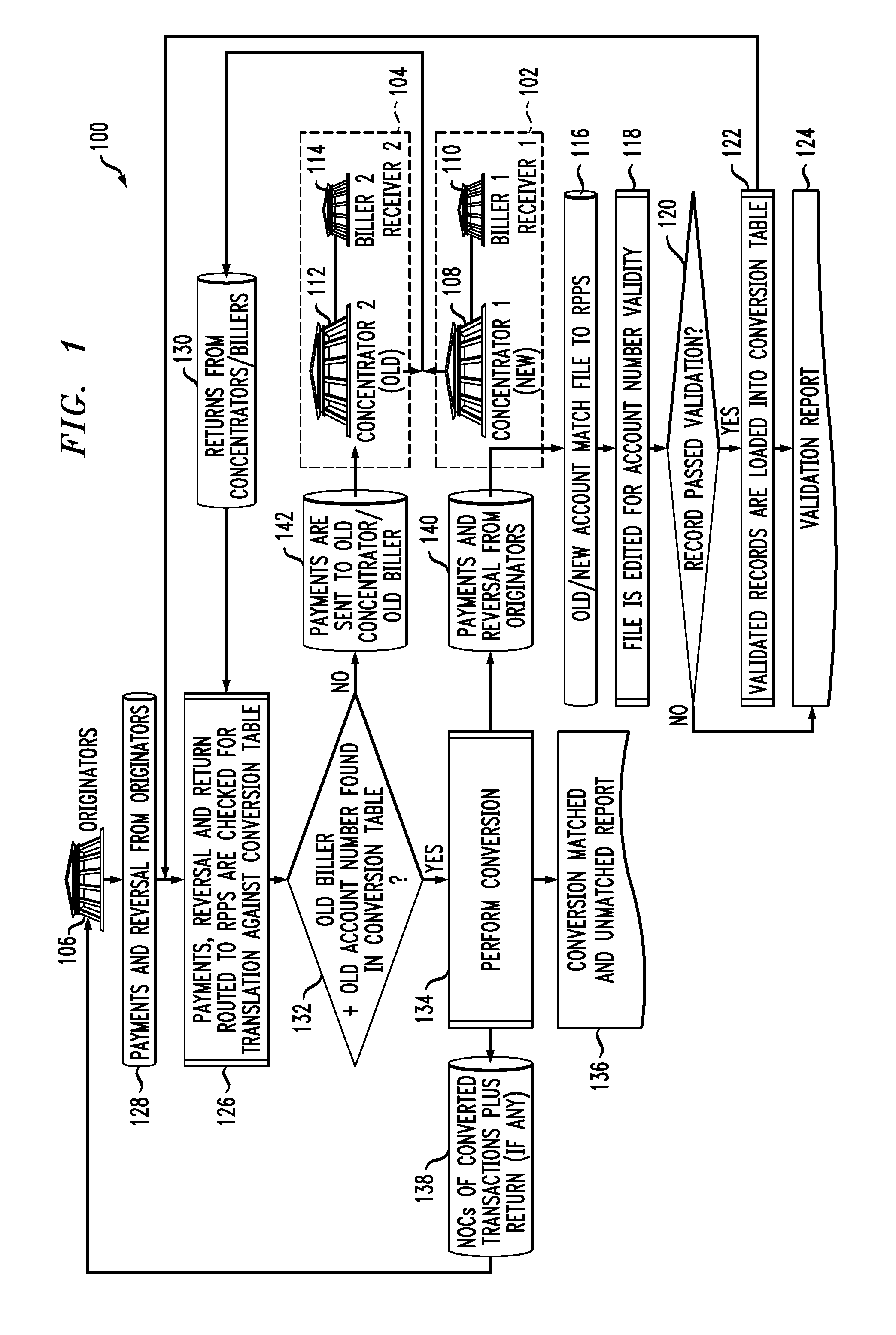

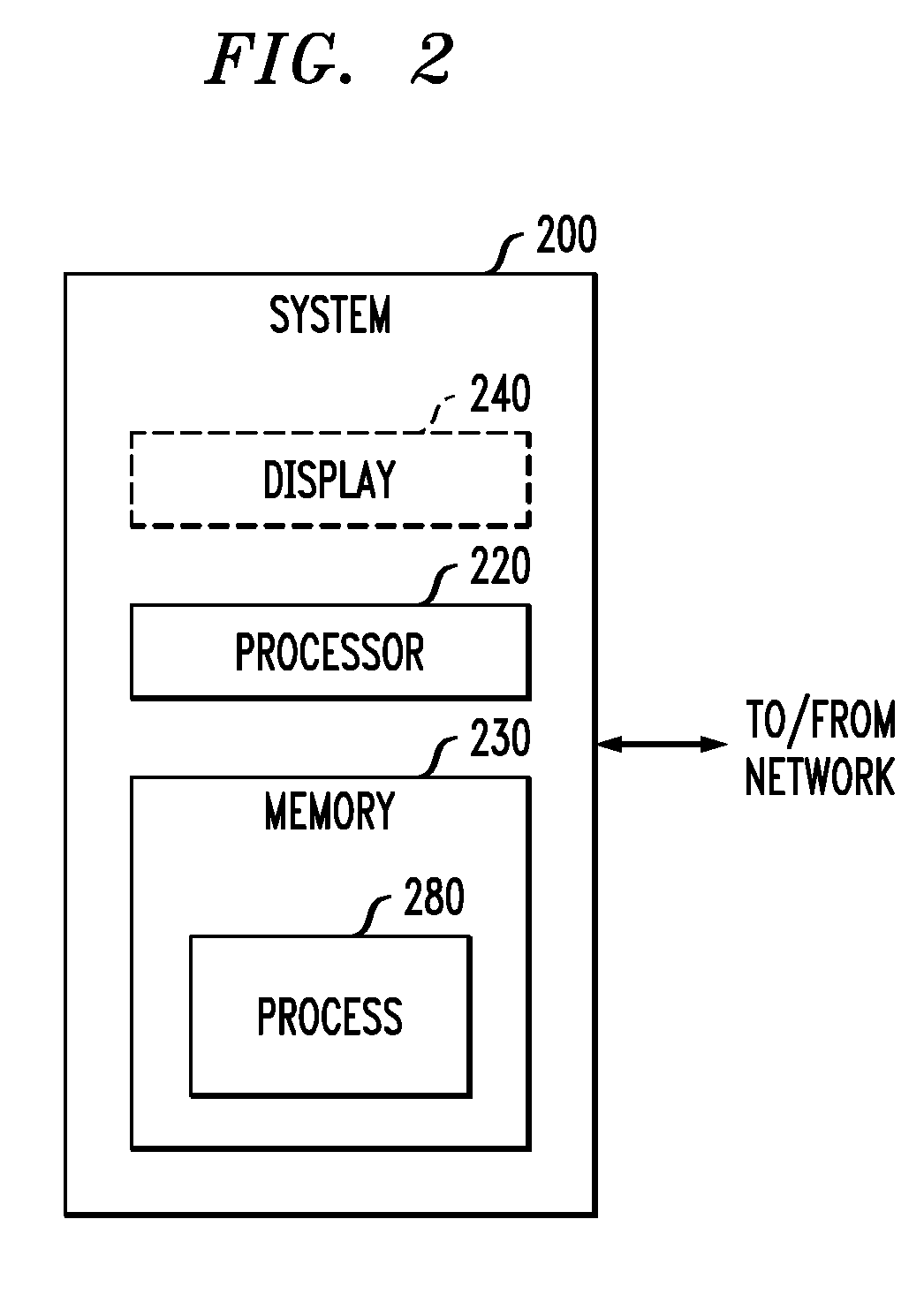

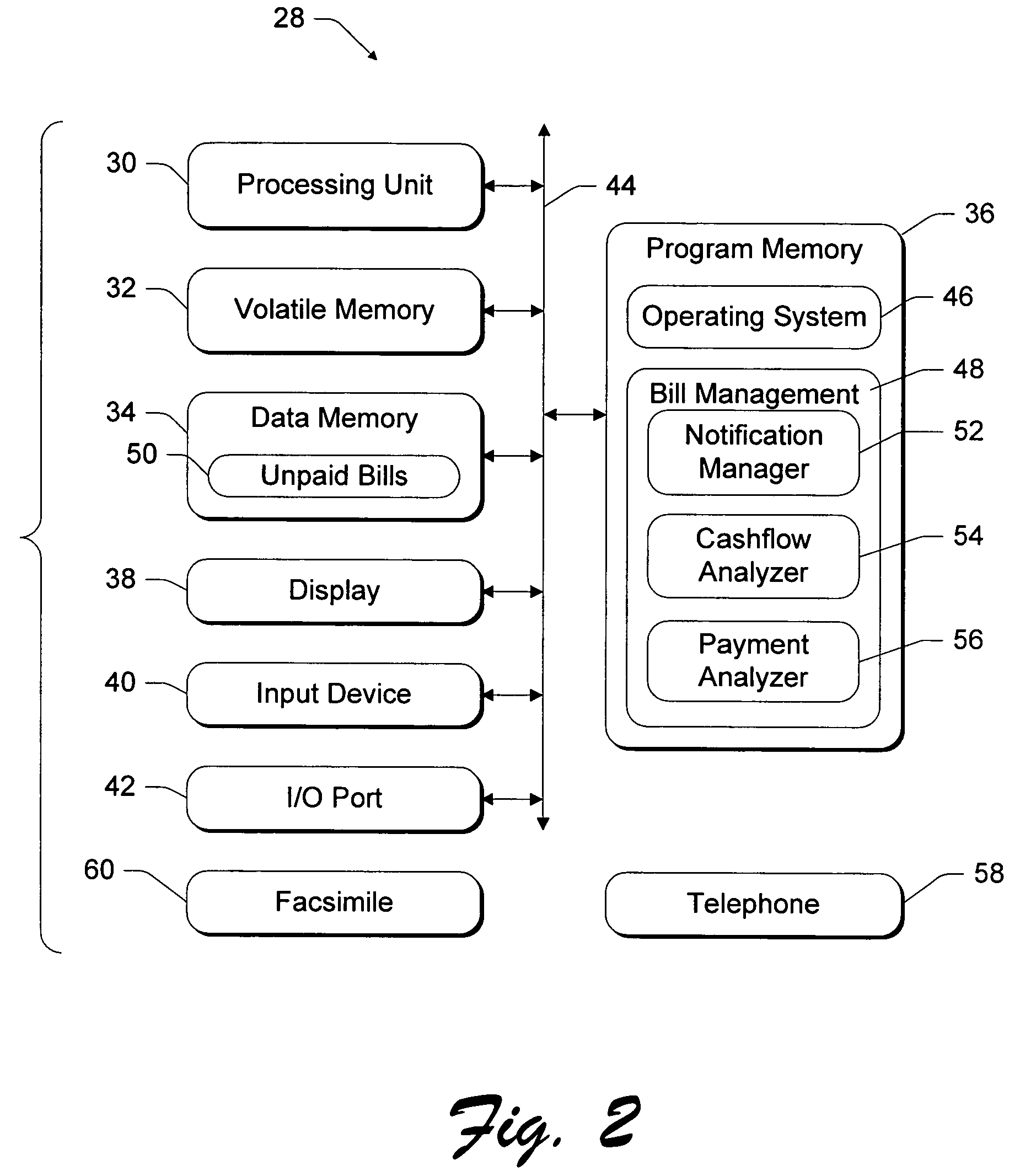

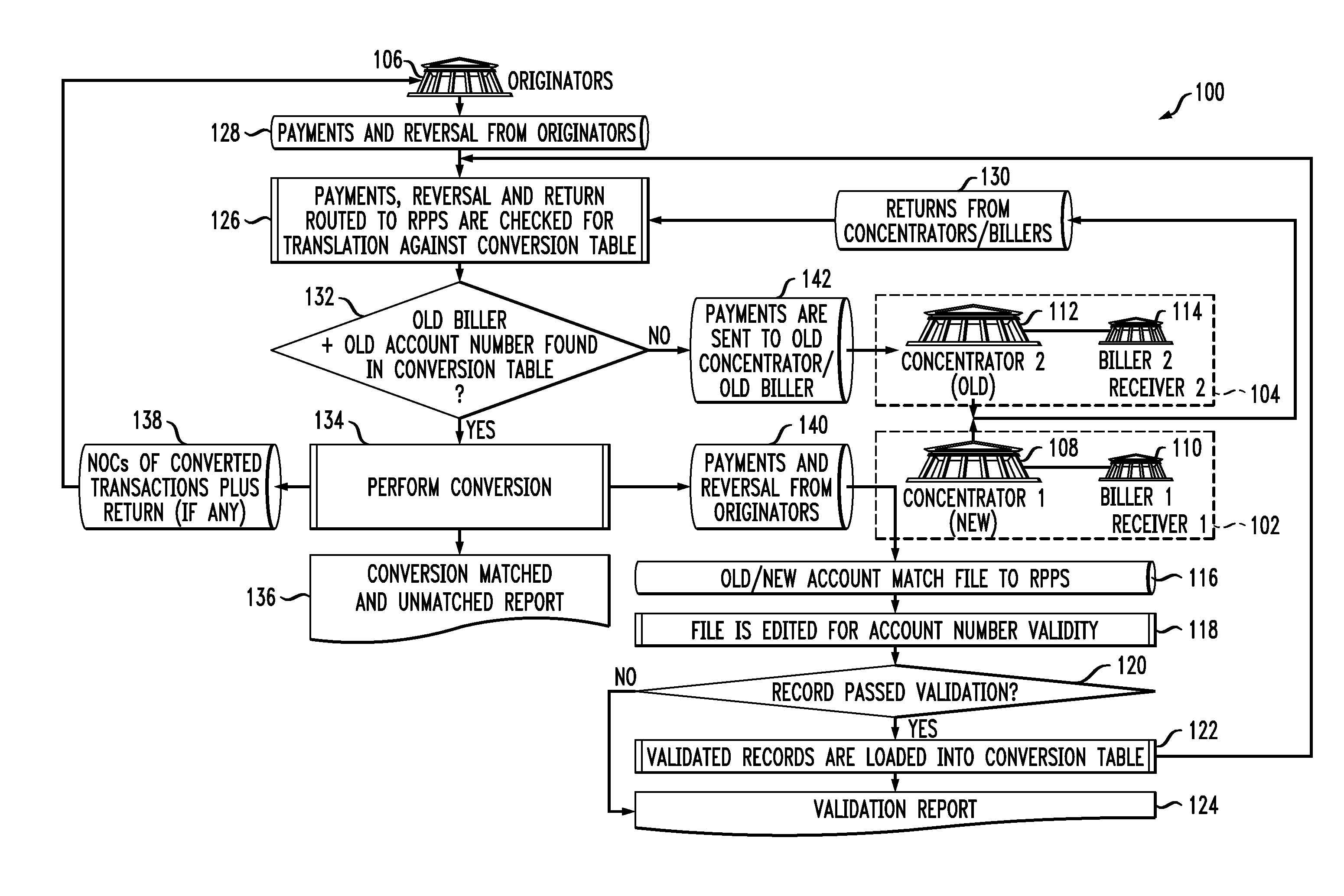

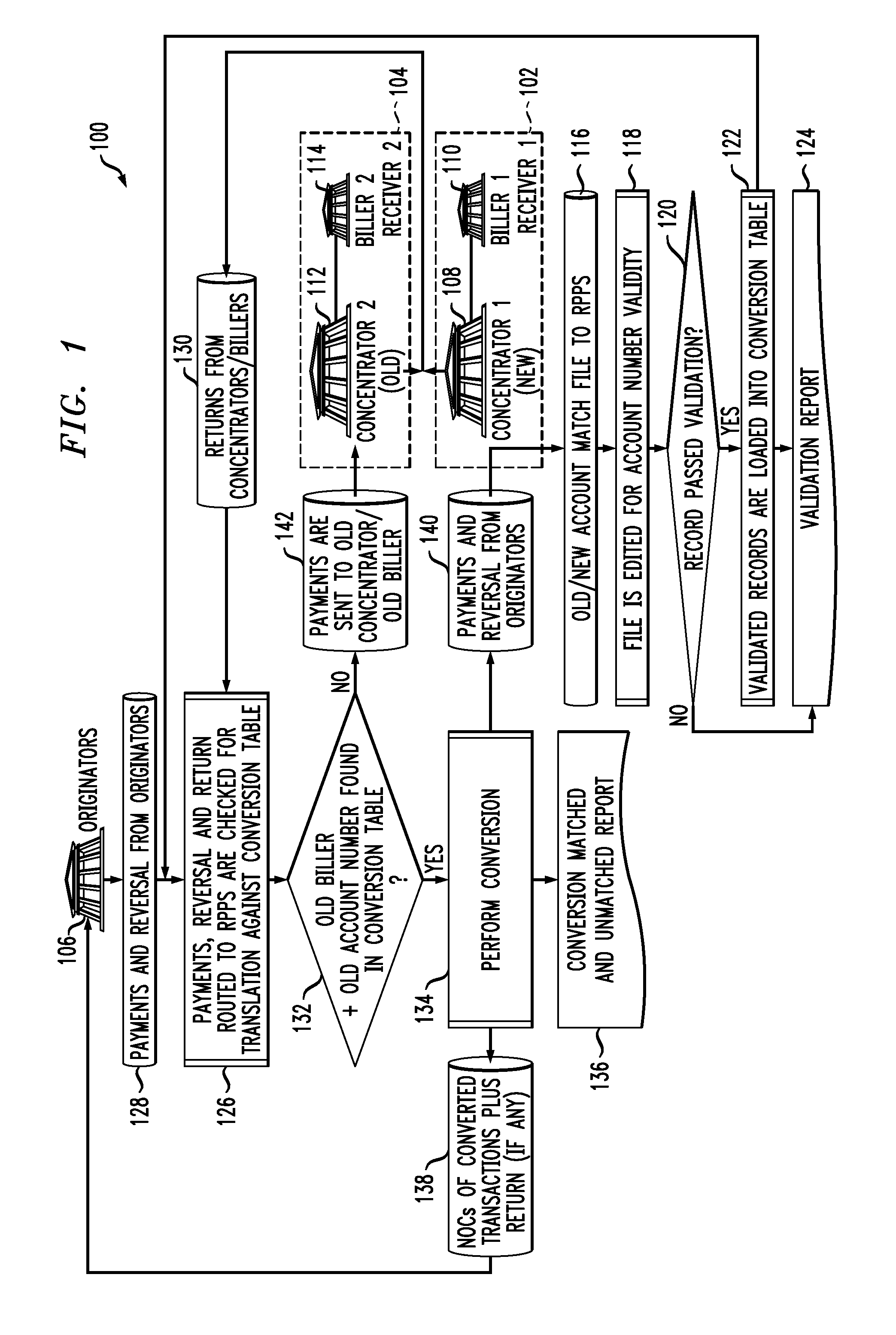

Apparatus and method for facilitating account restructuring in an electronic bill payment system

A system can have a plurality of participating entities including a plurality of receivers and a plurality of originators. A data file indicative of an account restructuring of a given one of the receivers can be obtained. The data file specifies at least one old account number associated with the receiver and at least one new account number associated with the receiver. The data is placed in a conversion data structure in a format to facilitate account number conversion. Remittance data, including the old or new account number of the receiver, is obtained from a given one of the participating entities, and is routed in accordance with the old or new account number in the remittance data, and the data structure.

Owner:MASTERCARD INT INC

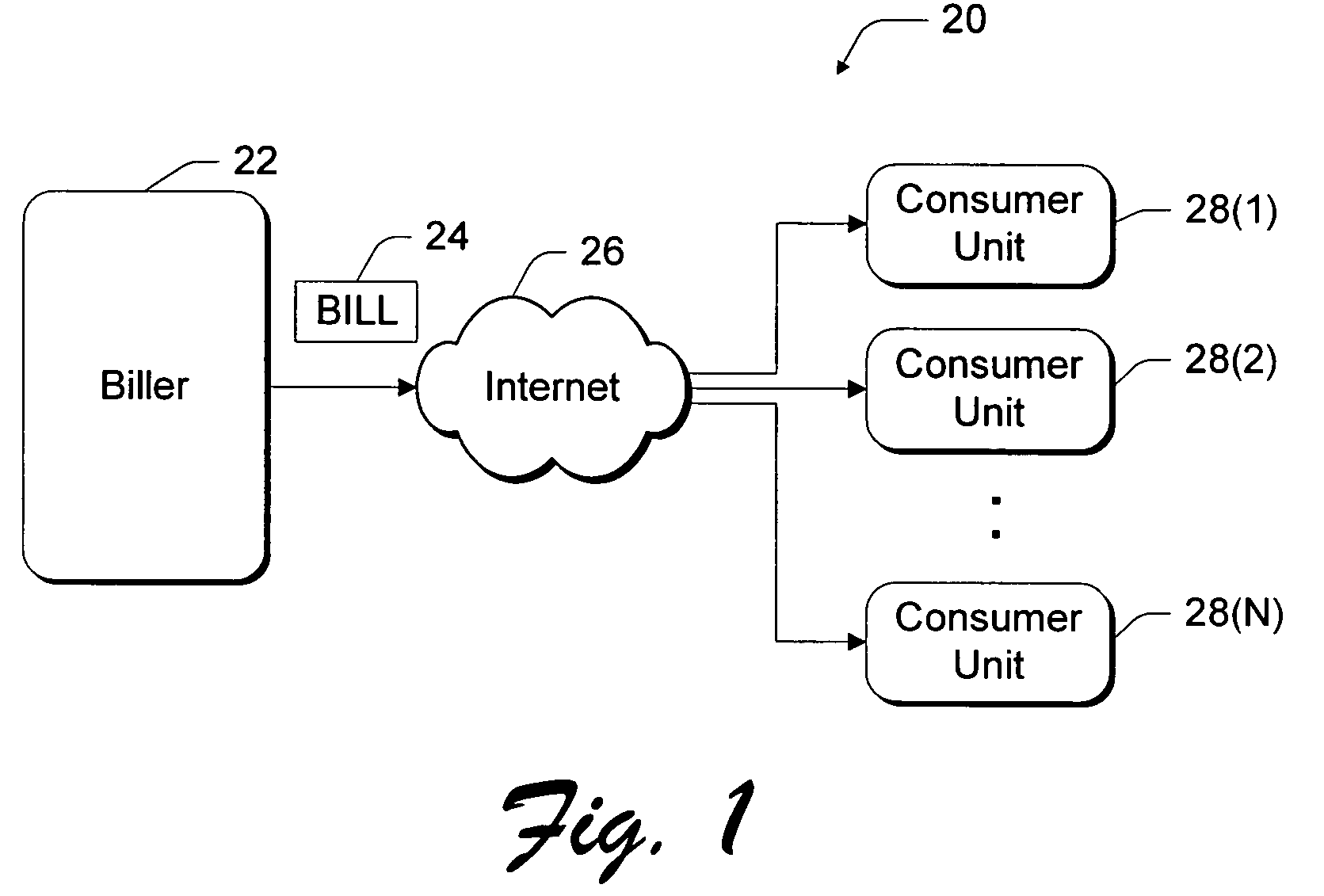

Consumer-based system and method for managing and paying electronic billing statements

InactiveUS20050065883A1Minimizing overdraftMinimizes overdraftFinanceDigital computer detailsPayment scheduleGraphics

A consumer-based bill management and payment system is configured to receive, analyze, manage and pay electronic billing statements received from the biller over the Internet. The system includes a notification manager that detects when the electronic bill arrives and notifies the consumer. The bill is stored in memory with other unpaid electronic bills. According to another aspect of the invention, the system has a cashflow analyzer that enables the consumer to coordinate the unpaid electronic bills according to different payment schedules for a bill payment cycle (e.g., a month). The goal of the manipulation is to permit the consumer to analyze how the different payment schedules affect the consumer's cashflow with an aim toward minimizing overdraft during the bill payment cycle. The cashflow analyzer can automatically compute an optimized payment schedule that minimizes overdraft of the consumer's account, while maximizing the balance to generate the most interest. When the consumer desires to pay a particular bill, the bill is presented to the consumer through a graphical user interface (UI). The bill management and payment system supports a payment analyzer to enable the consumer to determine how much of the electronic bill to pay. The payment analyzer provides a venue to challenge certain items on the bill.

Owner:MICROSOFT TECH LICENSING LLC

Apparatus And Method For Facilitating Account Restructuring In An Electronic Bill Payment System

A system can have a plurality of participating entities including a plurality of receivers and a plurality of originators. A data file indicative of an account restructuring of a given one of the receivers can be obtained. The data file specifies at least one old account number associated with the receiver and at least one new account number associated with the receiver. The data is placed in a conversion data structure in a format to facilitate account number conversion. Remittance data, including the old or new account number of the receiver, is obtained from a given one of the participating entities, and is routed in accordance with the old or new account number in the remittance data, and the data structure.

Owner:MASTERCARD INT INC

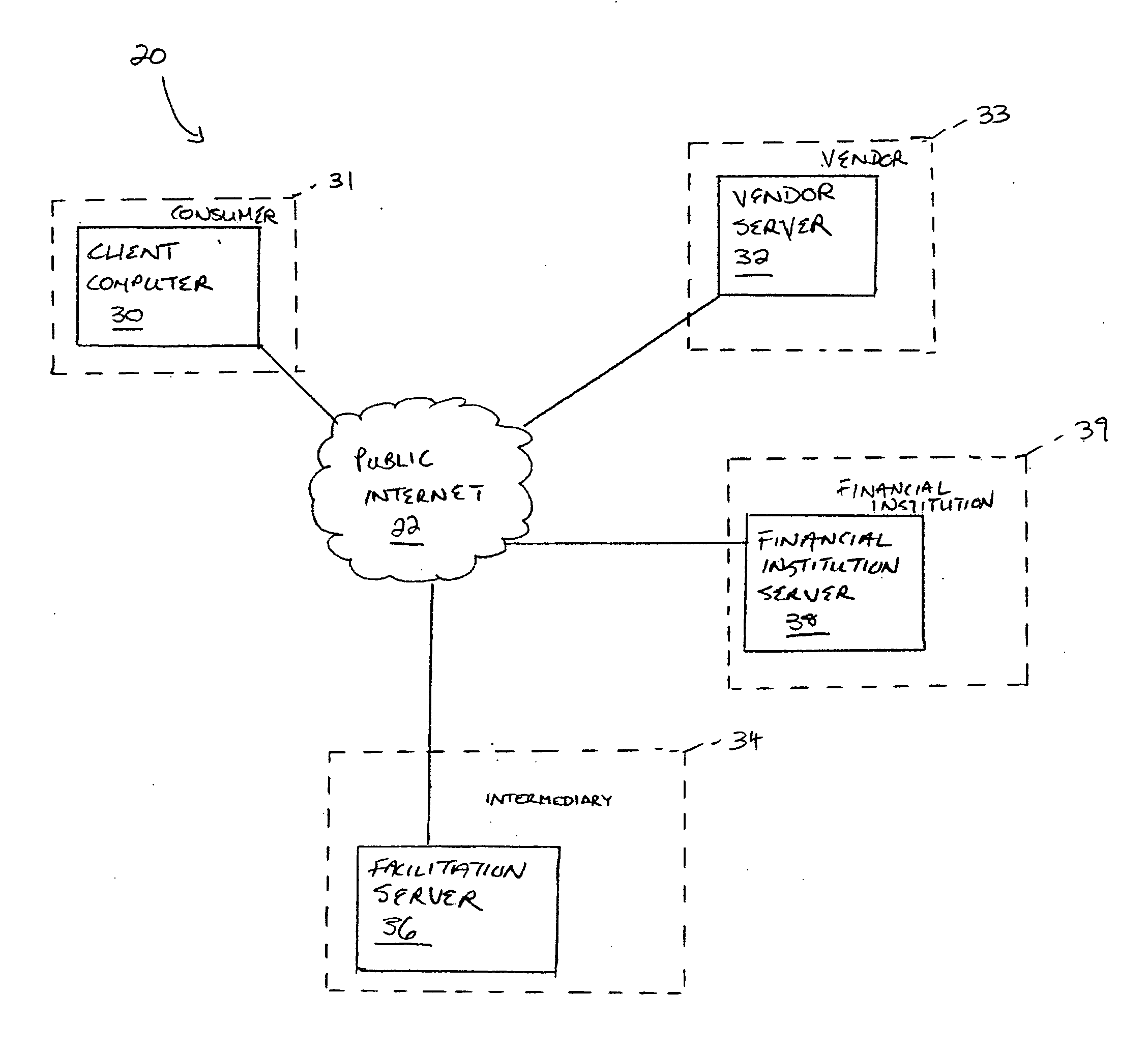

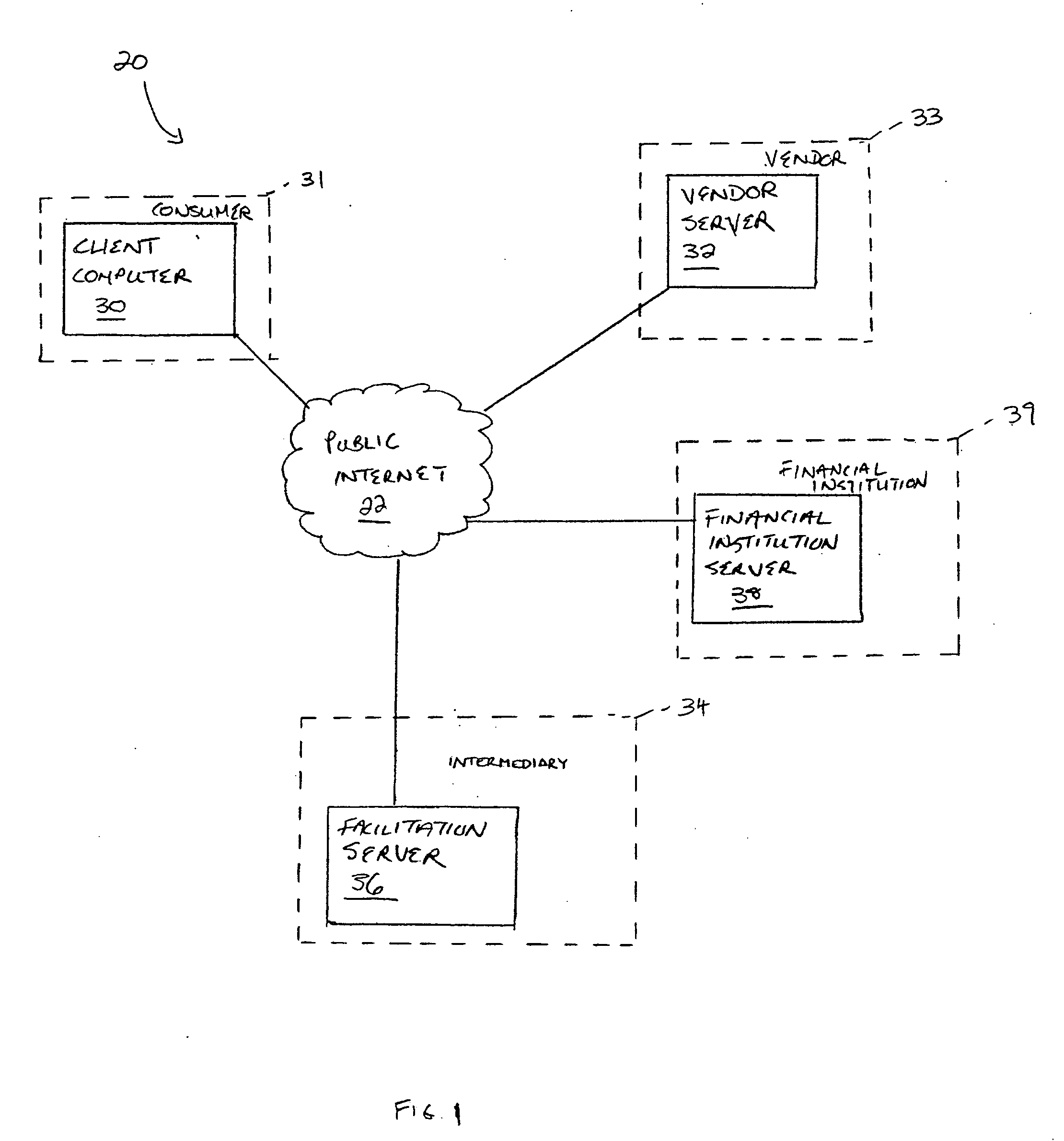

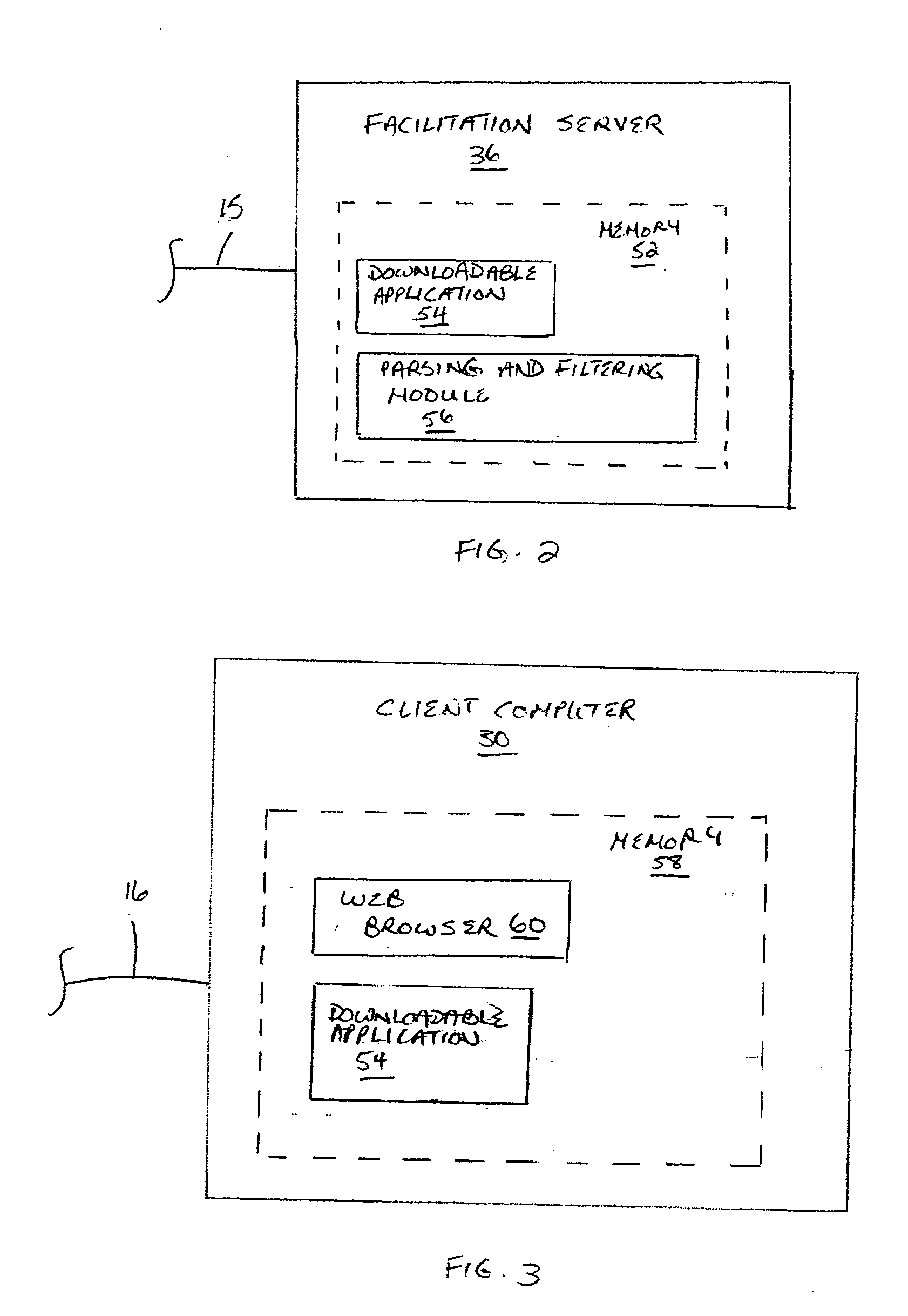

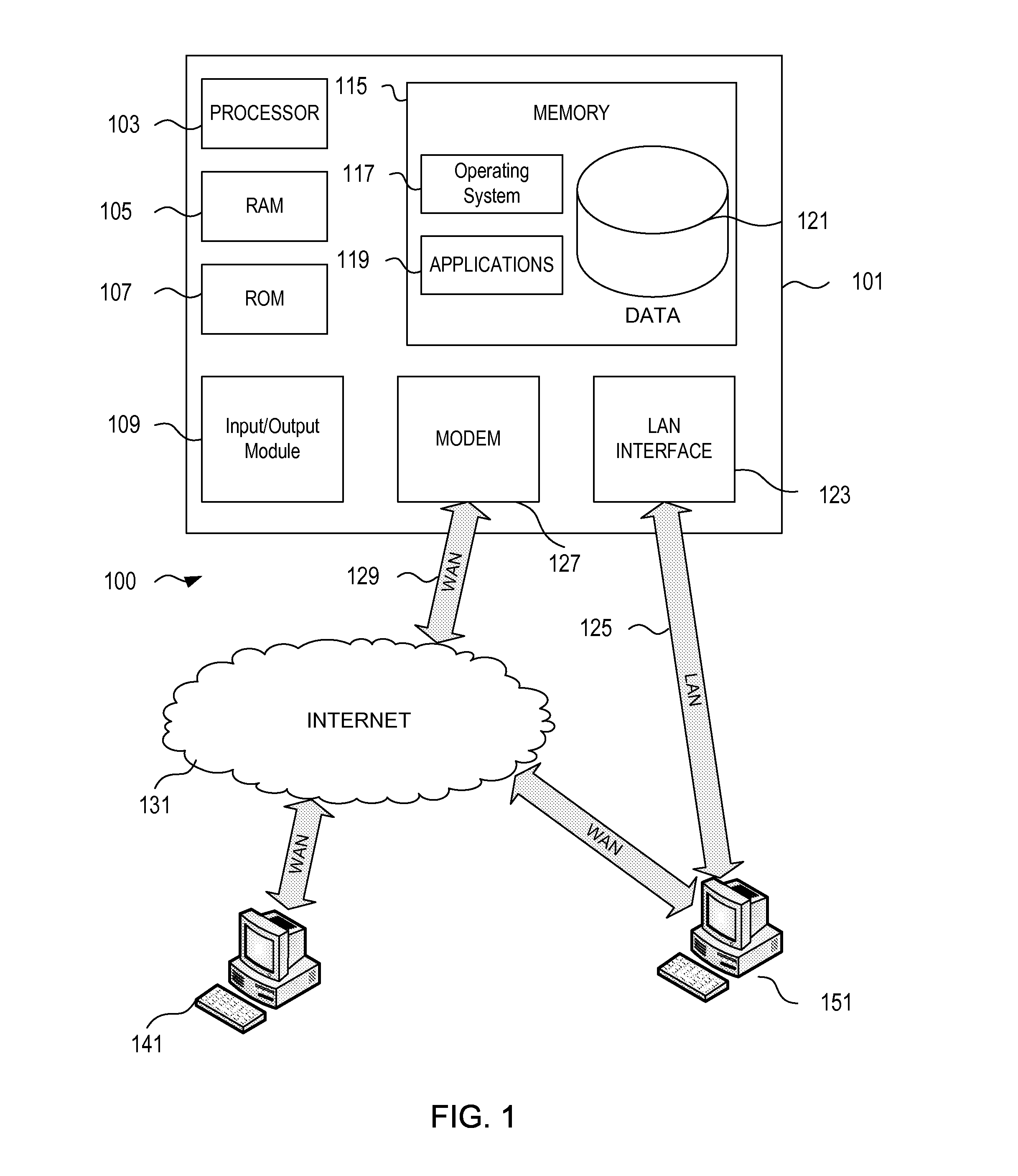

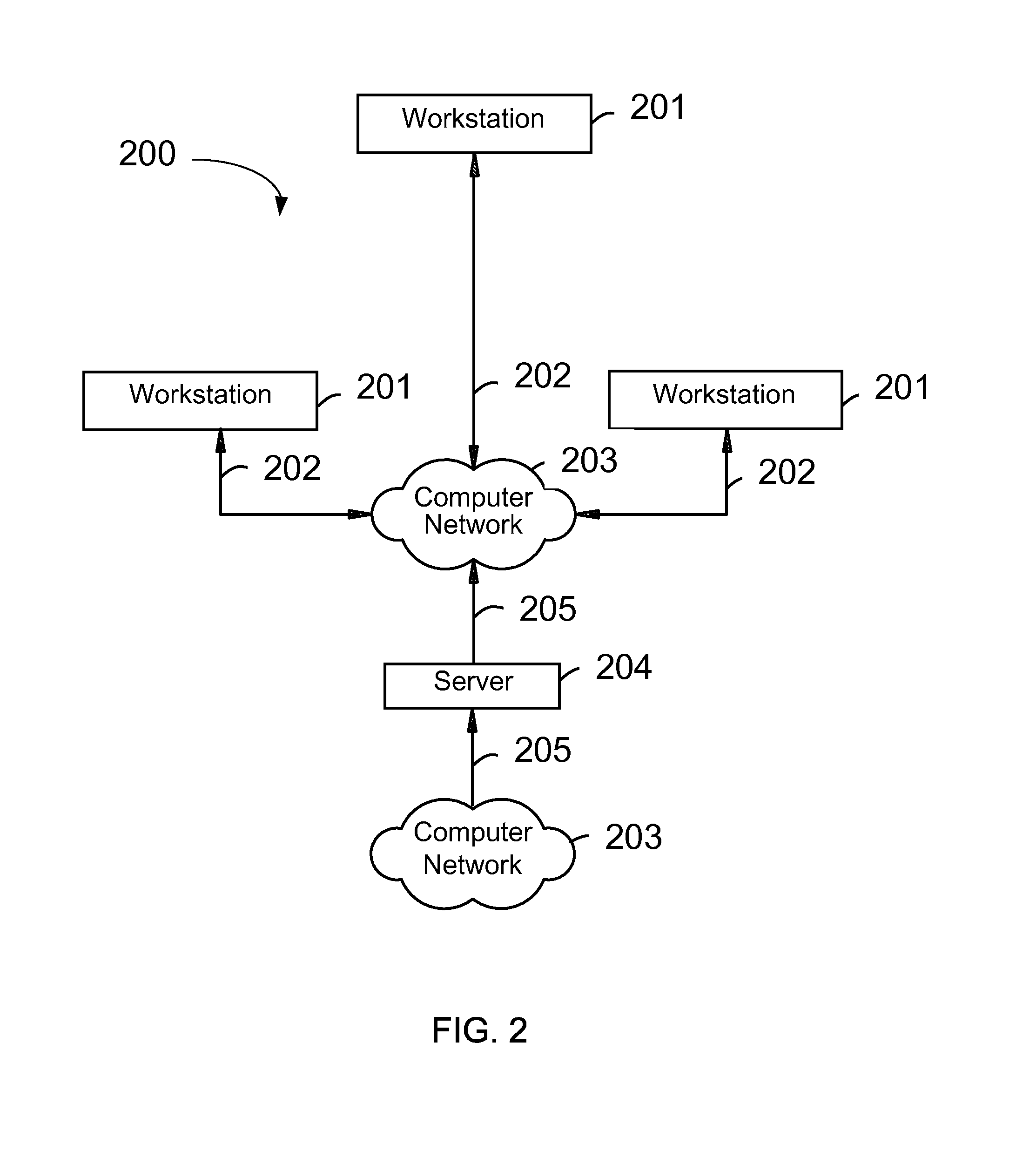

Electronic funds transfer

A consumer may make an electronic bill payment from his financial institution account to an intermediary for a certain amount. Data related to the bill payment transaction may be sent to a facilitation server associated with the intermediary. This data may be filtered to determine whether or not the data represents a valid bill payment transaction. If it does, an intermediate account provided by the intermediary, or an account of a third party (such as an on-line merchant) may be immediately credited with the amount of the bill payment so that the consumer can immediately use those funds in an on-line purchase.

Owner:NAVAHO NETWORKS

Anonymous Electronic Payment System

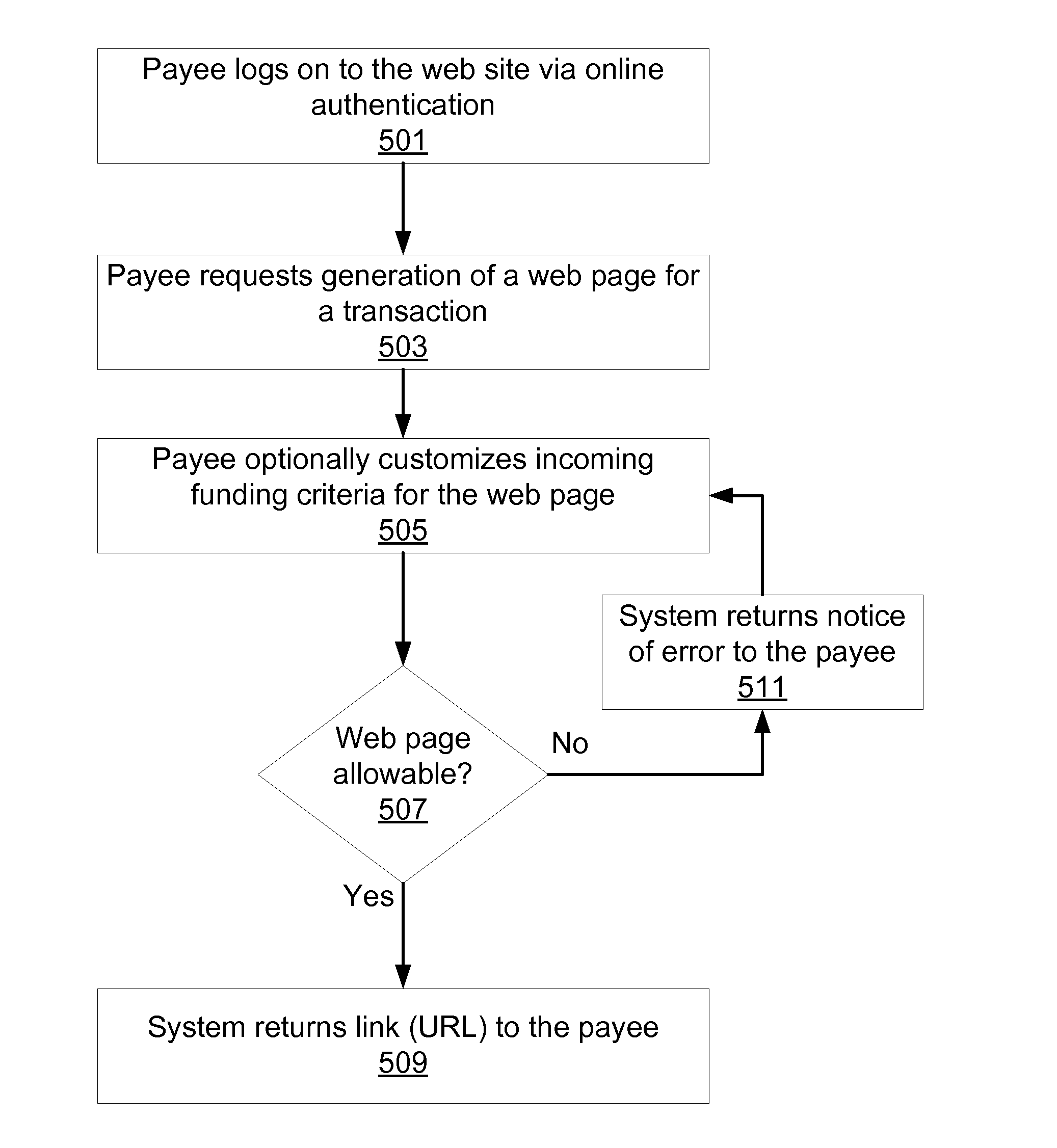

Systems and methods for autonomous online payments to an individual are described. A request to generate an electronic payment user interface associated with an individual for a transaction to an account associated with an entity is received. One or more individual defined criteria associated with the electronic payment user interface for the transaction is received. An Internet accessible address to the electronic payment user interface is generated. A request input from a payer to access, via the Internet accessible address, the electronic payment user interface associated with the individual is received. An authorization input from the payer to make an electronic payment of monetary funds from an account of the payer to the account of the individual is received, and access by the individual to personally identifiable information of the payer regarding the transaction is prevented.

Owner:BANK OF AMERICA CORP

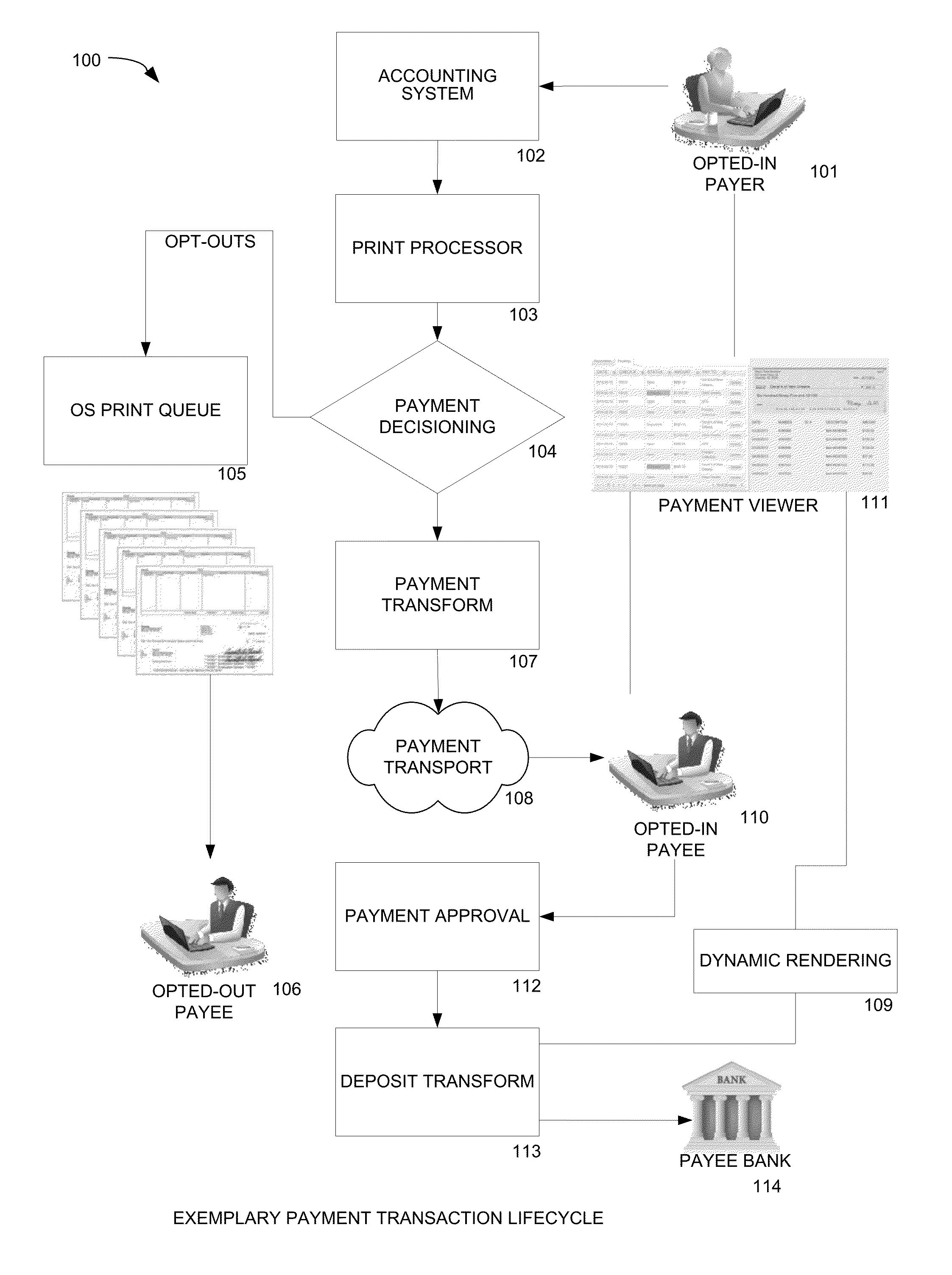

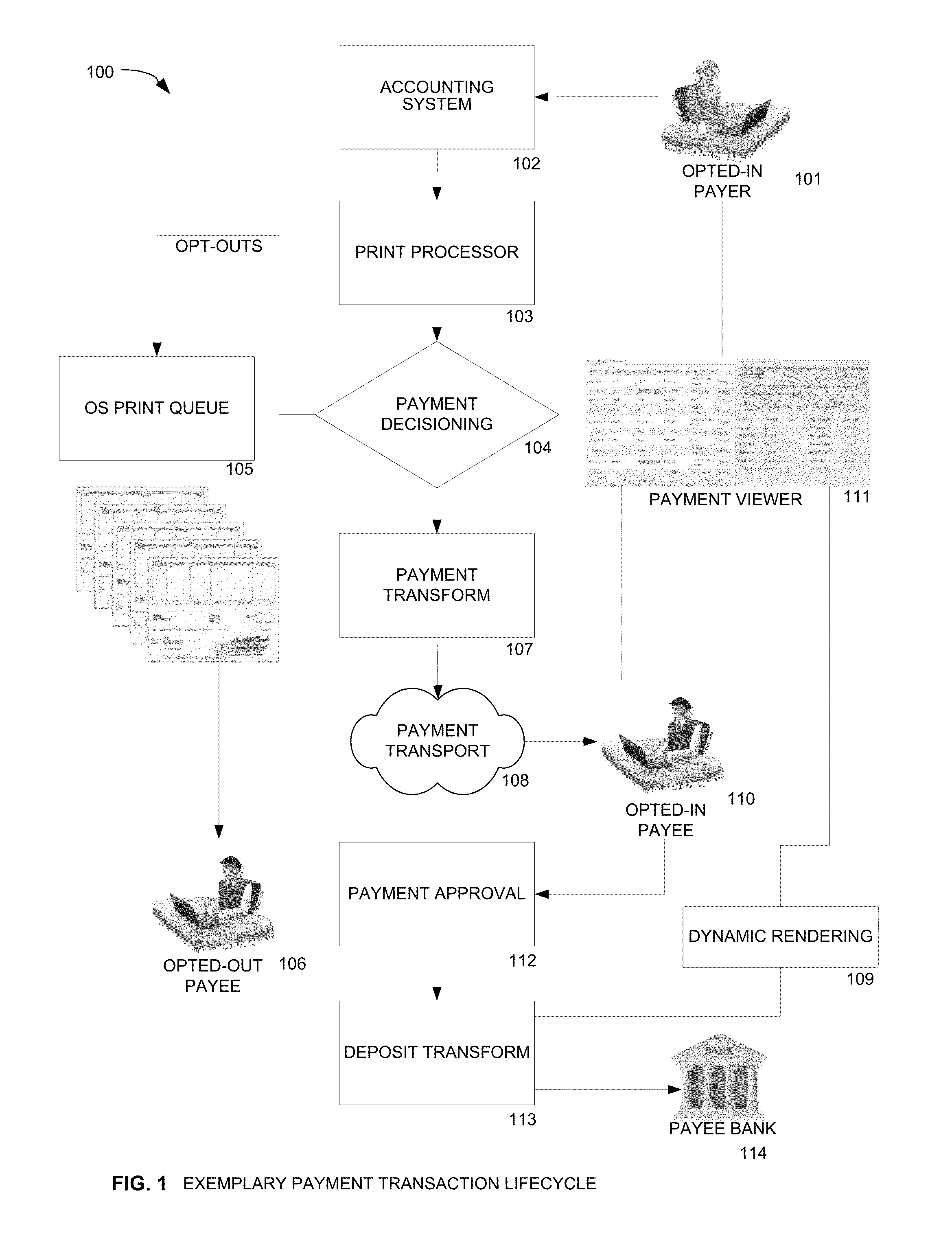

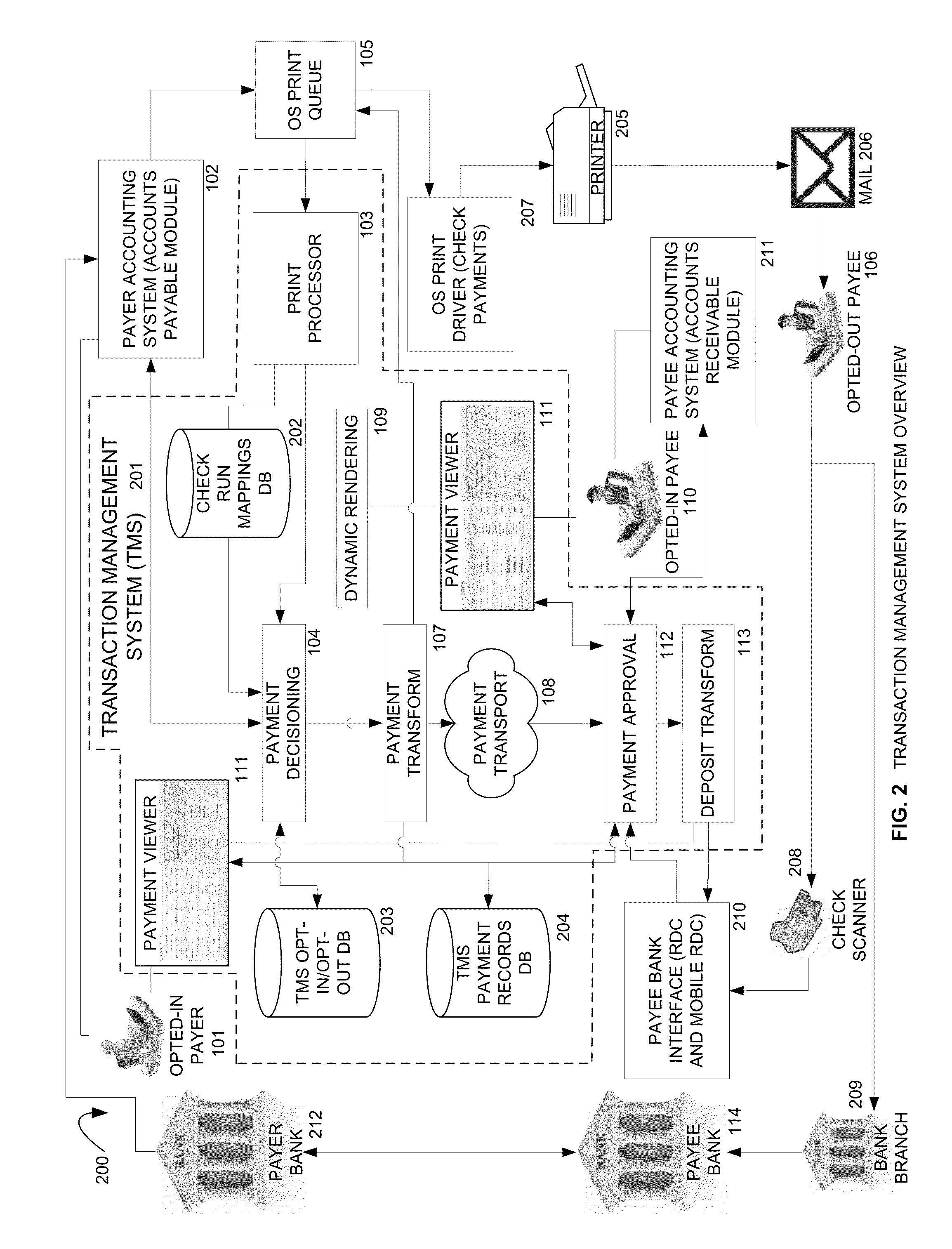

Electronic Payment System Operative with Existing Accounting Software and Existing Remote Deposit Capture and Mobile RDC Software

InactiveUS20140279310A1Alteration can be preventedPrevent theftComplete banking machinesFinanceChequePayment system

Methods and systems for providing an electronic payment to a payee on behalf of a payer. A transaction management system (TMS) receives payments data from an accounting system. The payments data is processed to determine if a payee has opted-in to receive electronic payments. If so, an electronic payment instruction is generated. If the payee has opted-out or is not in a payee file, a print file is generated for printing a conventional paper check. The payee is notified of the payment and can access the system to view a list of payments and remittance information. The payee can indicate a status for a payment on the list, e.g. accept or dispute the electronic payment. In response to selecting a payment in the payments list, the payee is provided with a view of an electronic check representation generated from the electronic payment instruction. The payer can access the payment status in the system to determine if a payment has been accepted. If accepted, the electronic payment instruction is transmitted to a payment recipient system in the form of electronic check representation.

Owner:KOKOPAY

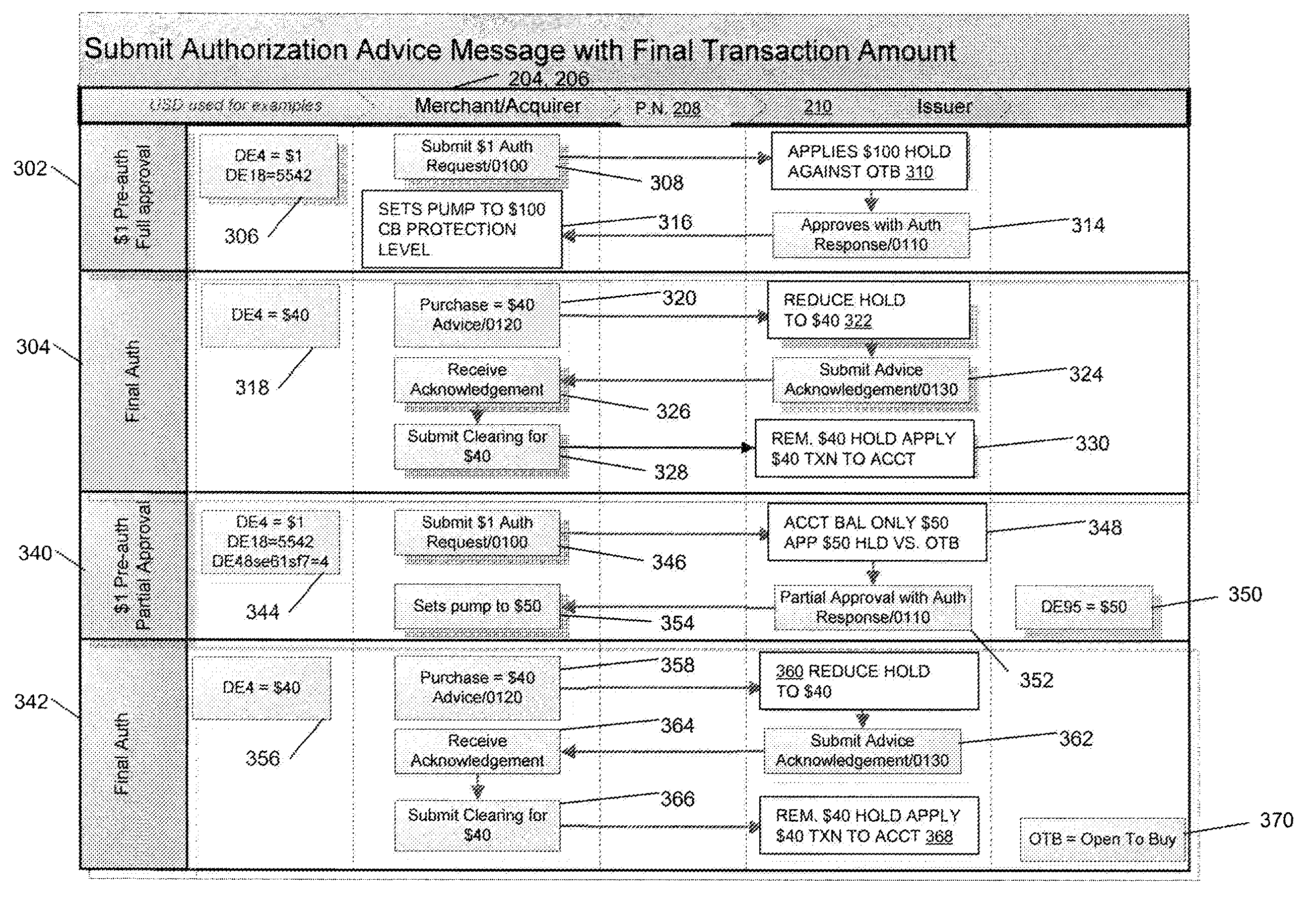

Method and apparatus for addressing issuer hold for automated fuel dispenser transactions in an electronic payment system

Placement of a hold amount against a payment card account of a customer is facilitated, in response to the customer presenting a payment device, associated with the payment card account, in connection with a non-PIN, signature-based, dual-message transaction with a merchant. The presenting of the payment device is prior to a time when an amount of the transaction can be determined. Subsequent to the placement of the hold amount, immediately after the time when the amount of the transaction can be determined, transmission of an authorization advice message from an acquirer associated with the merchant to an issuer of the payment device is facilitated. The authorization advice message indicates the amount of the transaction. A further step includes facilitating the issuer of the payment device releasing any portion of the hold amount which exceeds the amount of the transaction, immediately responsive to the authorization advice message.

Owner:MASTERCARD INT INC

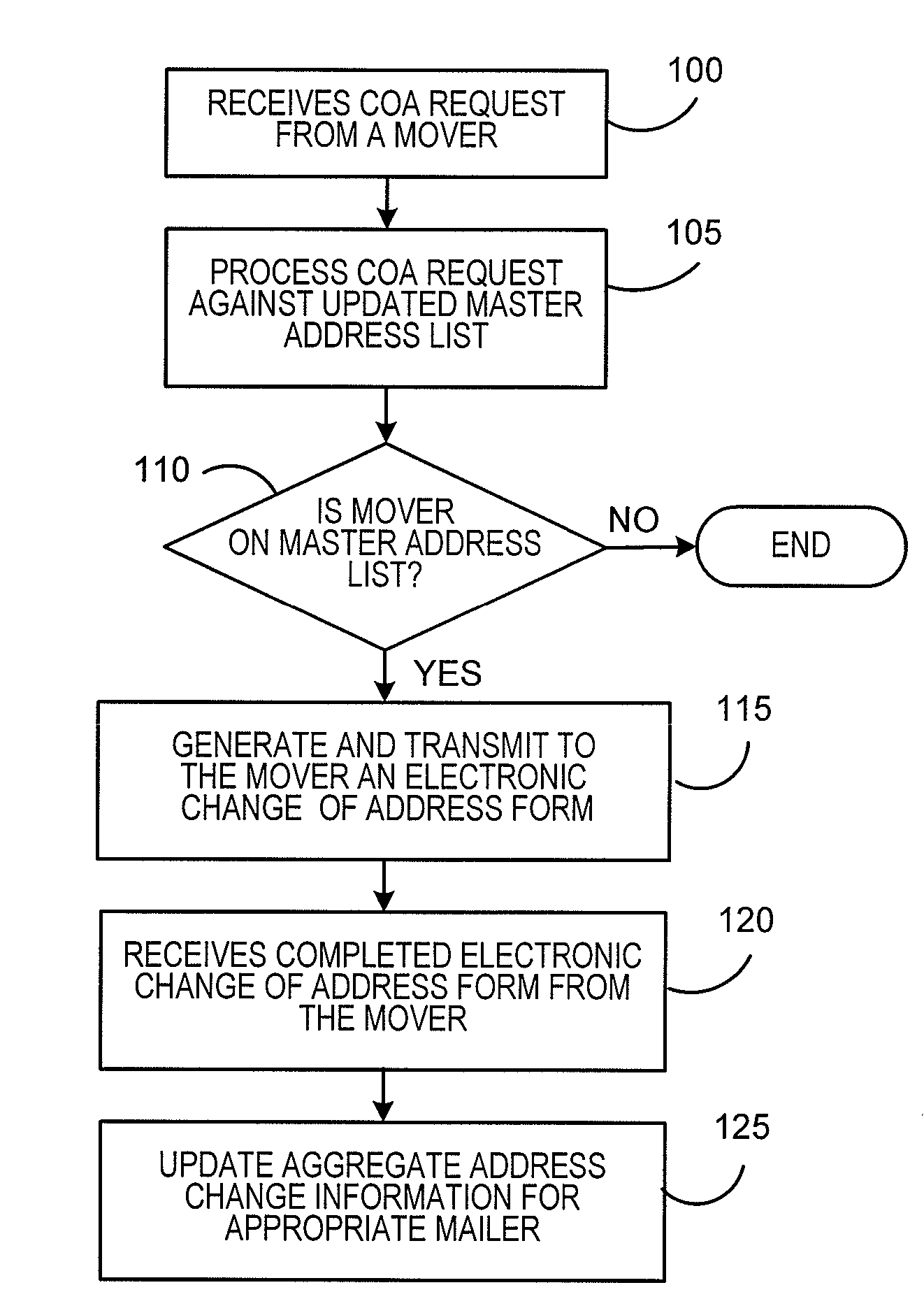

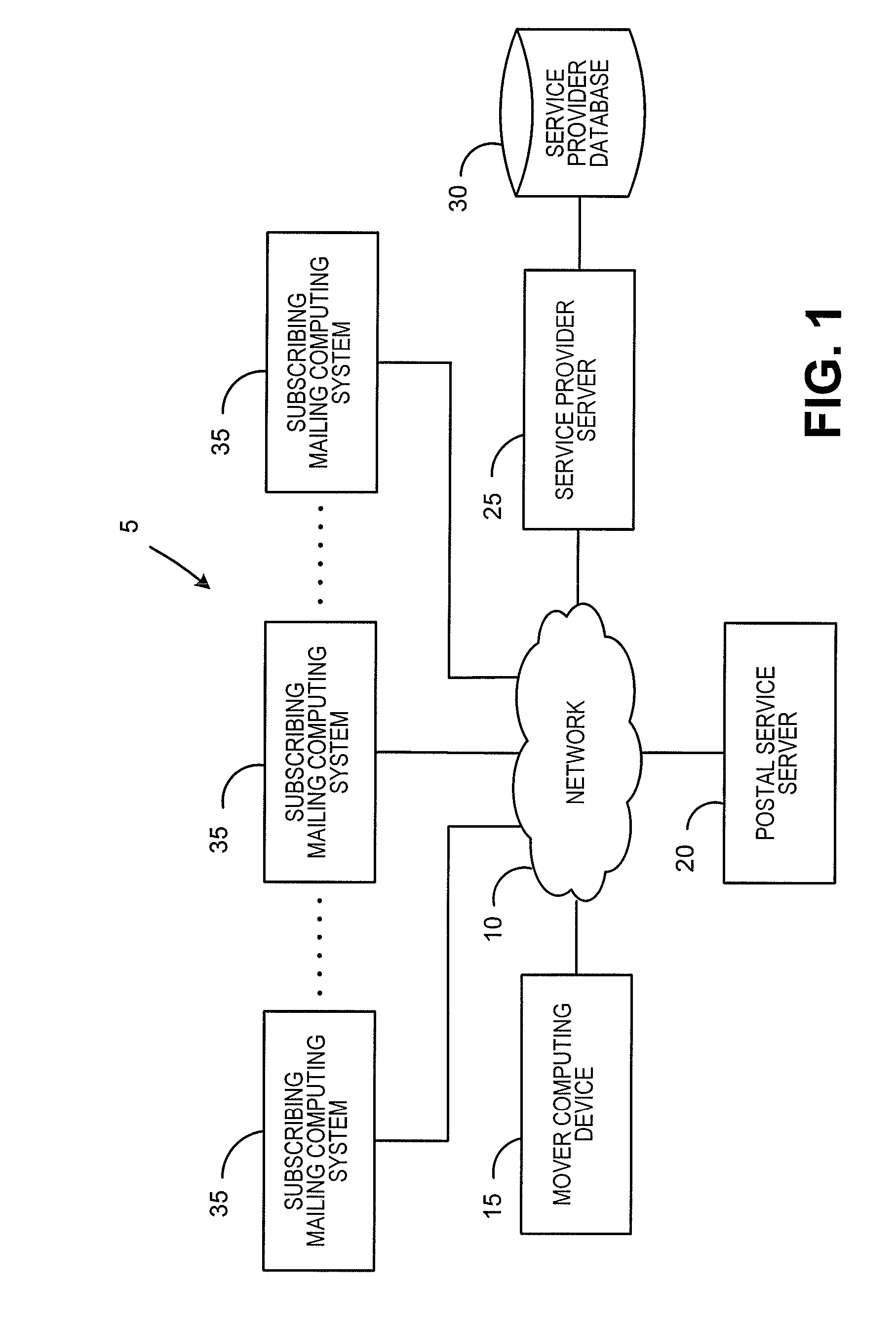

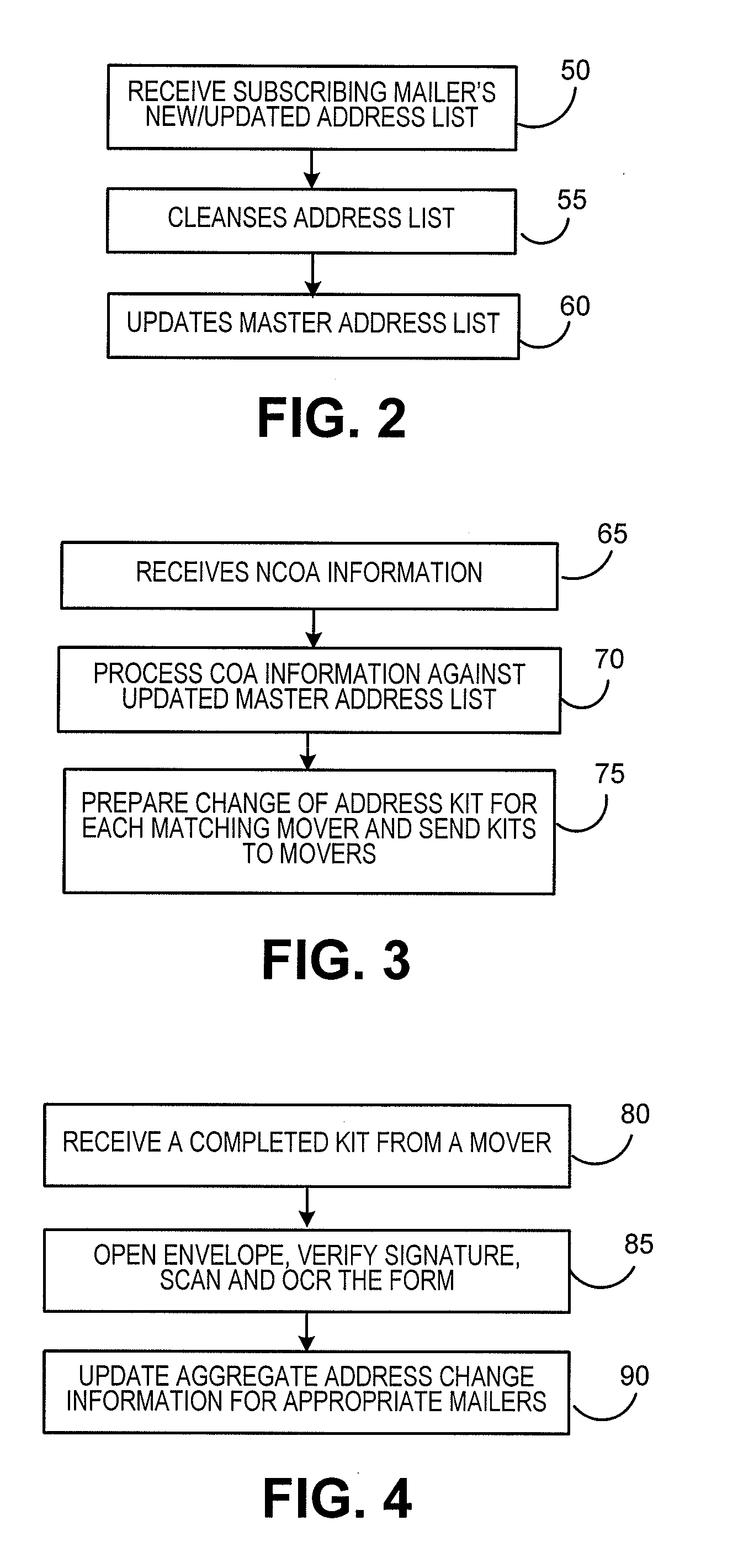

Methods for facilitating contact information changes

InactiveUS20090157470A1Easy maintenanceBilling/invoicingSpecial data processing applicationsPaymentPostal service

A method of facilitating the maintenance of an address list of each of a plurality of mailers wherein master address information based on current address list information received from each of the mailers is maintained, and wherein the mailers are automatically notified of address changes based on change of address information for a plurality of movers provided. Also, a method of facilitating the maintenance of an address list of each of a plurality of mailers in response to a change of address request being provided to a postal service by a mover that specifies a new address for the mover. Finally, a method of assisting a party to notify selected payees of one or more changes in contact related information for the party that is provided in conjunction with an electronic bill payment system through which a party makes payments to the payees.

Owner:PITNEY BOWES INC

System and method of electronic payment using payee provided transaction identification codes

InactiveUS20160071087A1High degreeImprove convenienceFinanceBuying/selling/leasing transactionsPaymentFinancial transaction

Computerized payment method using short, temporary, transaction ID (TID) symbols for secure payer (customer) financial transactions. Payees (e.g. merchants) register their unique ID telecommunications devices (e.g. Smartphone and phone number), and financial institution a payment server. When a payee (merchant) and wish to do a financial transaction, the payee requests a TID from the server for that amount. The server sends a TID to the payee, which the payee then communicates to the payer. The payer in turn relays this TID to the server, which validates the transaction using the payer device. The server then releases funds to the payee. The server preserves records for auditing, but security is enhanced because the merchant never directly accesses the customer's financial account. Use of GPS coordinates and / or payer provided Group IDs may also be used to reduce the number of symbols used in the TID while continuing to ensure uniqueness.

Owner:MITTAL MILLIND

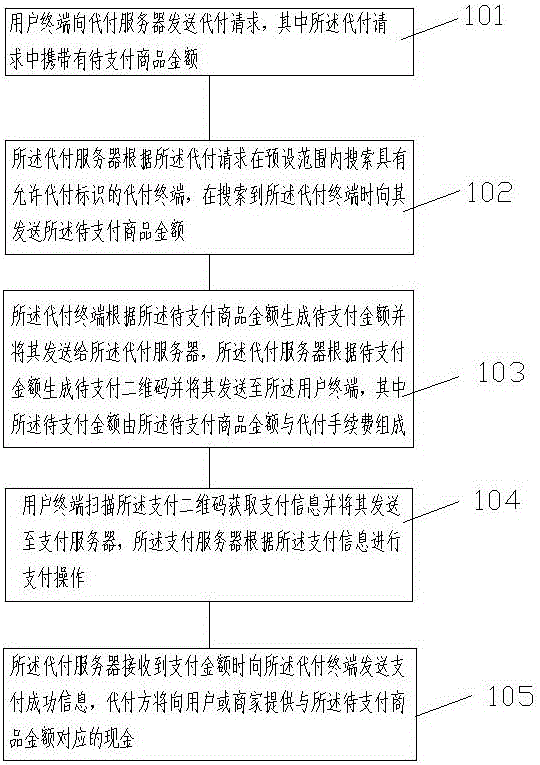

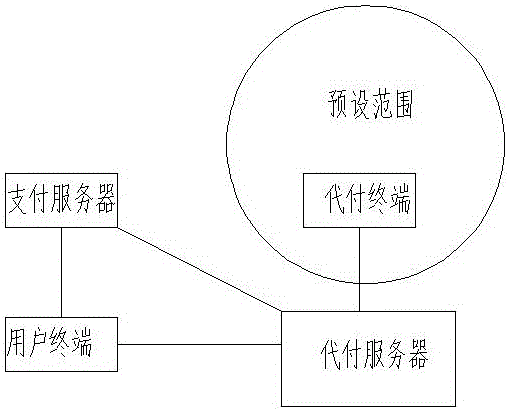

Electronic payment method and electronic payment system based on short-range payment substitution

InactiveCN106096941ASafety of tradementIncrease success ratePayment schemes/modelsComputer networkPayment order

The invention provides an electronic payment method and an electronic payment system based on short-range payment substitution. The electronic payment method comprises the steps of transmitting a payment substitution request by a user terminal to a payment substitution server, wherein the payment substitution request carries sum of to-be-paid commodities; searching a payment substitution terminal with an allowed payment substitution identification in a preset range by the payment substitution server, and transmitting the sum of the to-be-paid commodities to the payment substitution terminal; generating a to-be-paid sum by the payment substitution terminal and transmitting the to-be-paid sum to the payment substitution server, generating a to-be-paid two-dimensional code by the payment substitution server and transmitting the to-be-paid two-dimensional code to the user terminal, wherein the to-be-paid two-dimensional sum is composed of the sum of the to-be-paid commodities and a to-be-paid commission; scanning the to-be-paid two-dimensional code by the user terminal and transmitting the to-be-paid two-dimensional code to a payment server, and performing payment operation by the payment server; when the payment substitution server receives the payment sum, transmitting payment success information to the payment substitution terminal, and supplying cash which corresponds with the sum of the to-be-paid commodities by the payment substitution party to a user or a seller.

Owner:韩斌

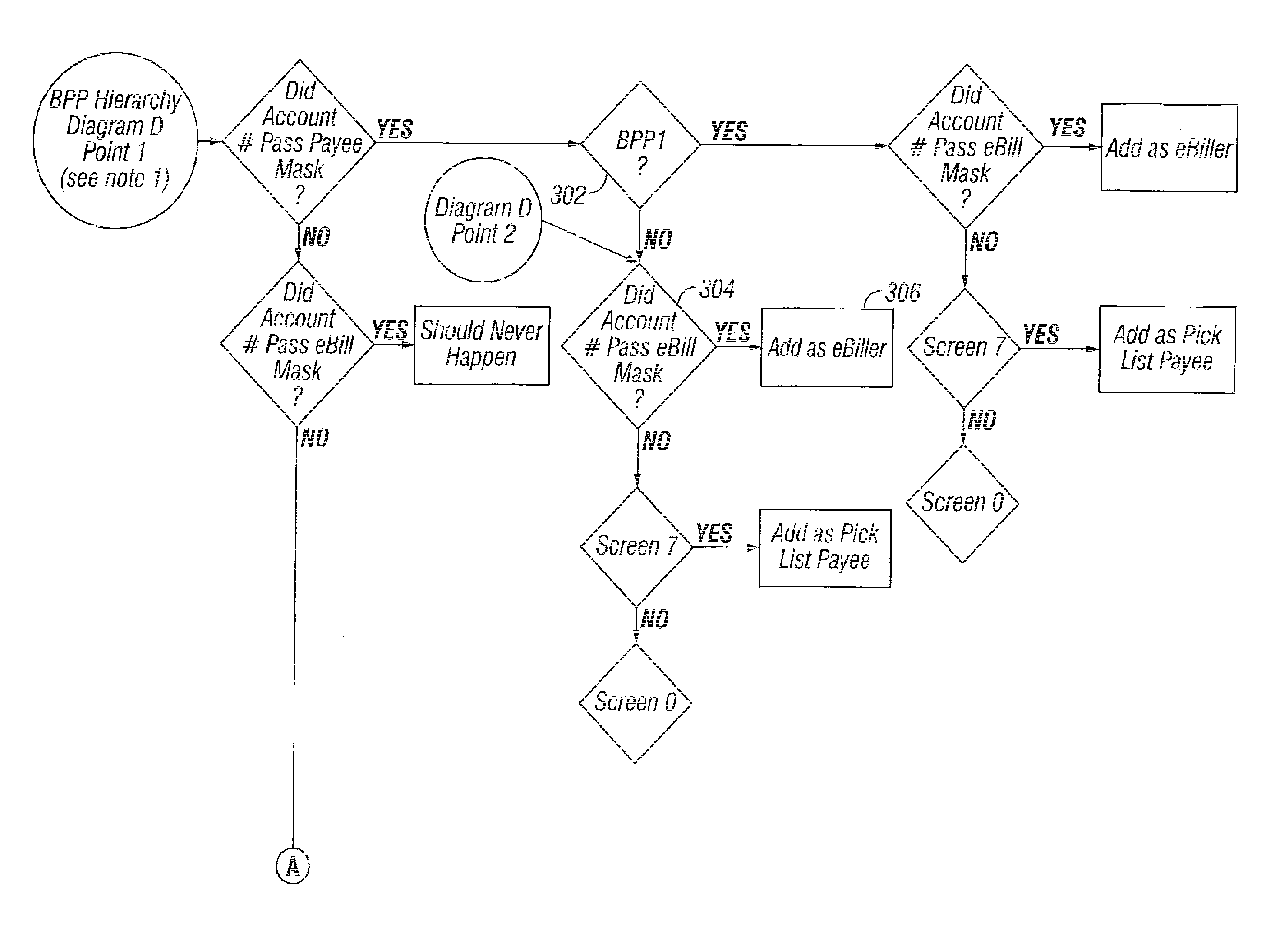

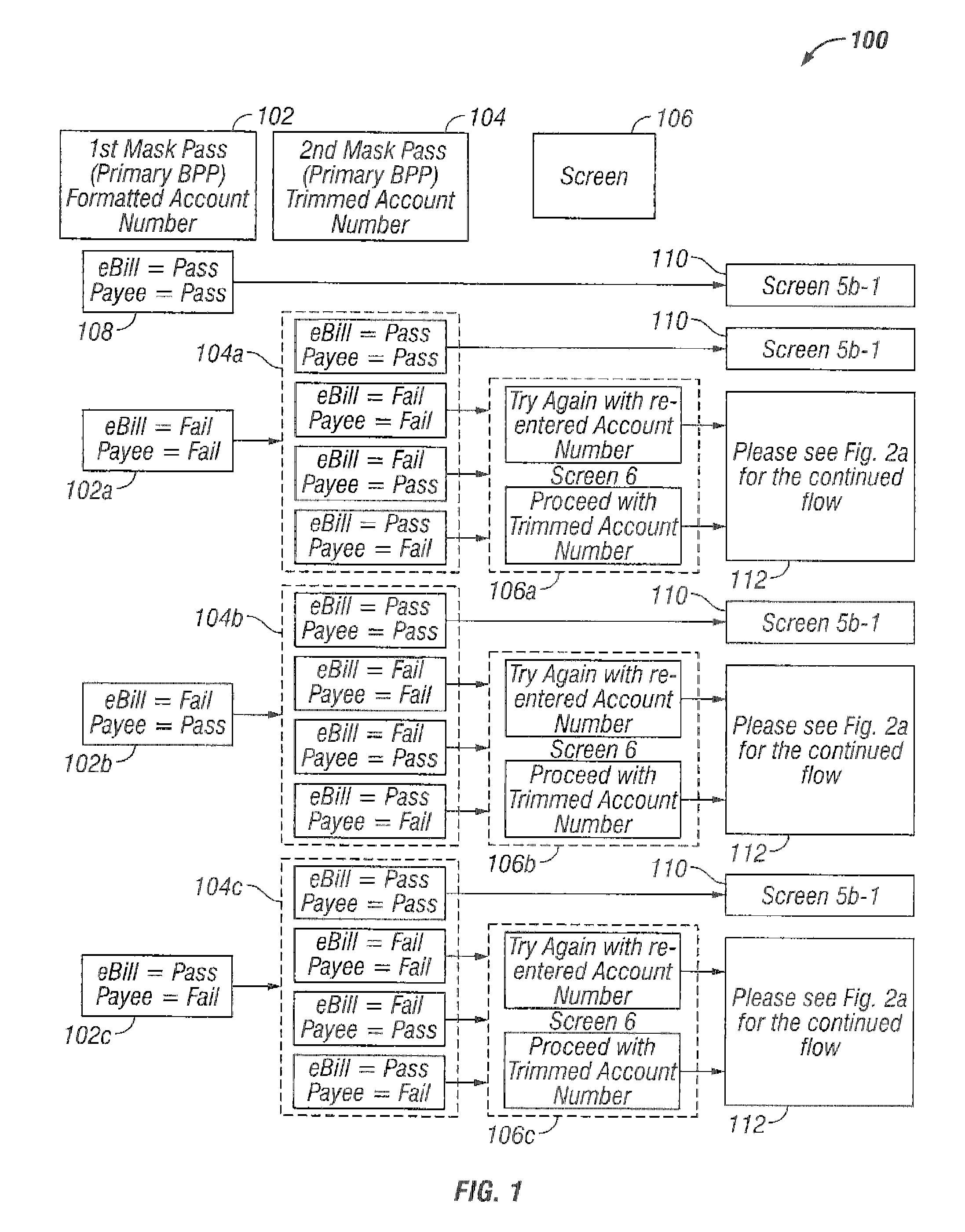

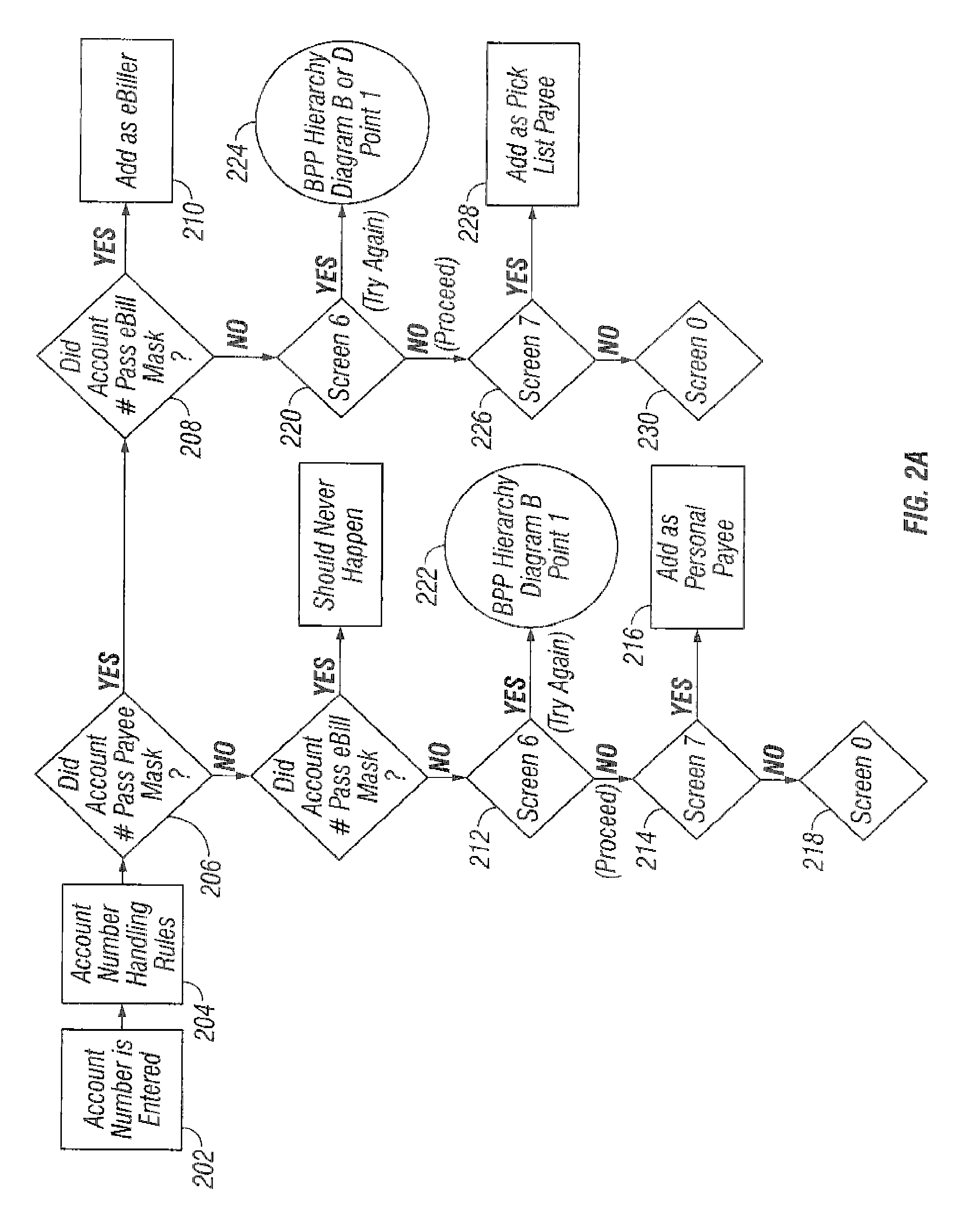

Electronic bill pay and bill presentment account number treatment system and method

A technique is provided that transforms account number data received from the consumer into one or more forms based on use by specific processes. Further provided is a technique for establishing payees using these account numbers such that remittances can be routed via the most cost effective means, e.g. which remittance processor is determined and / or which processor among internal processors within an enterprise is determined, and such that, when available, electronic bills can be successfully requested for on-line presentation. The technique to transform account number data can be applied by systems in industries other than banking and for account numbers from sources other than a customer.

Owner:WELLS FARGO BANK NA

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com