Patents

Literature

30 results about "IT risk" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Information technology risk, IT risk, IT-related risk, or cyber risk is any risk related to information technology. While information has long been appreciated as a valuable and important asset, the rise of the knowledge economy and the Digital Revolution has led to organizations becoming increasingly dependent on information, information processing and especially IT. Various events or incidents that compromise IT in some way can therefore cause adverse impacts on the organization's business processes or mission, ranging from inconsequential to catastrophic in scale.

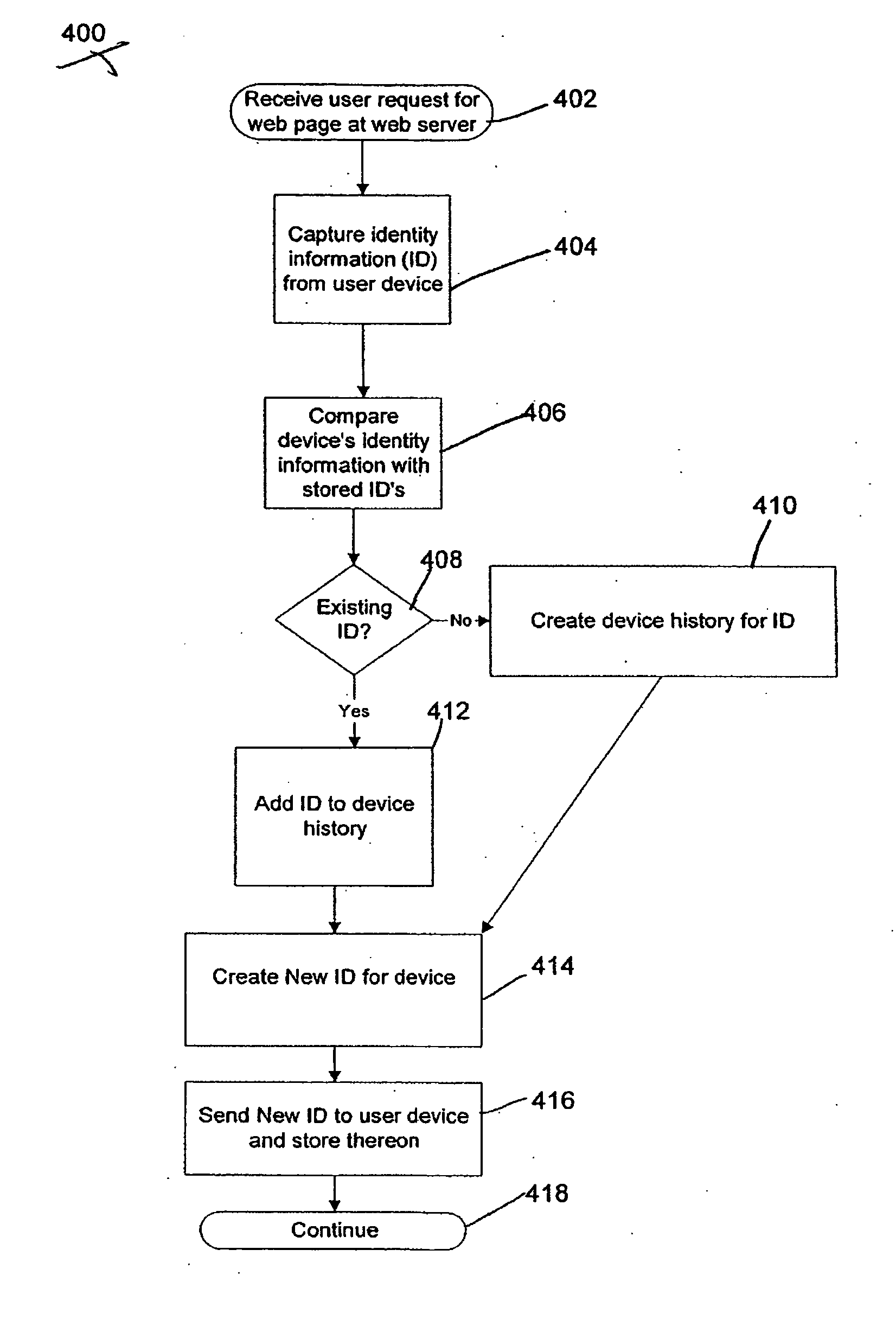

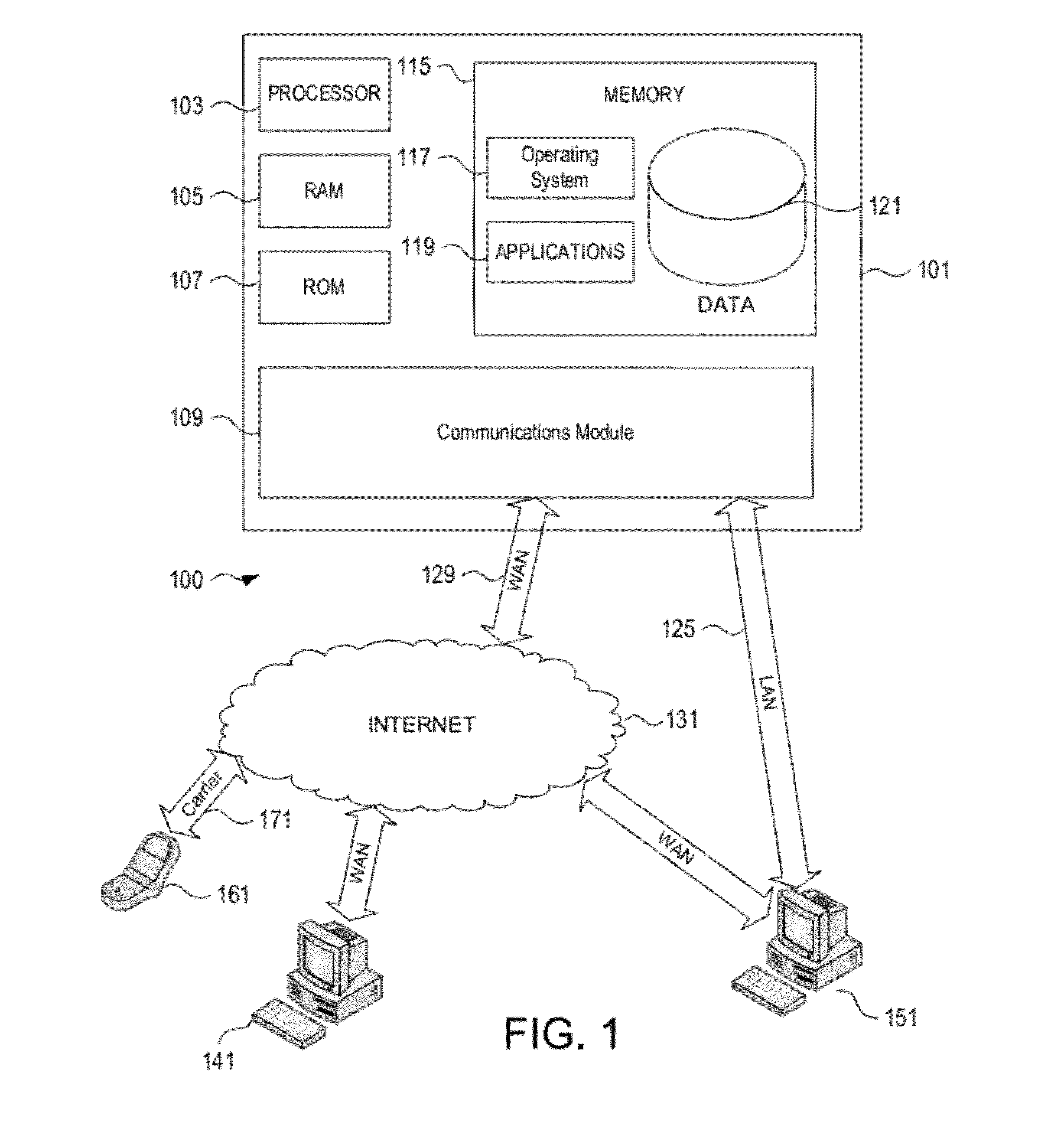

System and method for fraud monitoring, detection, and tiered user authentication

The present invention provides systems and methods for authenticating access requests from user devices by presenting one of a plurality of graphical user interfaces selected depending on a perceived risk of fraud associated with the devices. User devices are identified with fingerprinting information, and their associated risks of fraud are determined from past experience with the device or with similar devices and from third party information. In preferred embodiments, different graphical user interfaces are presented based on both fraud risk and, in the case of a known user, usability. In preferred embodiments, this invention is implemented as a number of communicating modules that identify user devices, assess their risk of fraud, present selected user interfaces, and maintain databases of fraud experiences. This invention also includes systems providing these authentication services.

Owner:ORACLE INT CORP

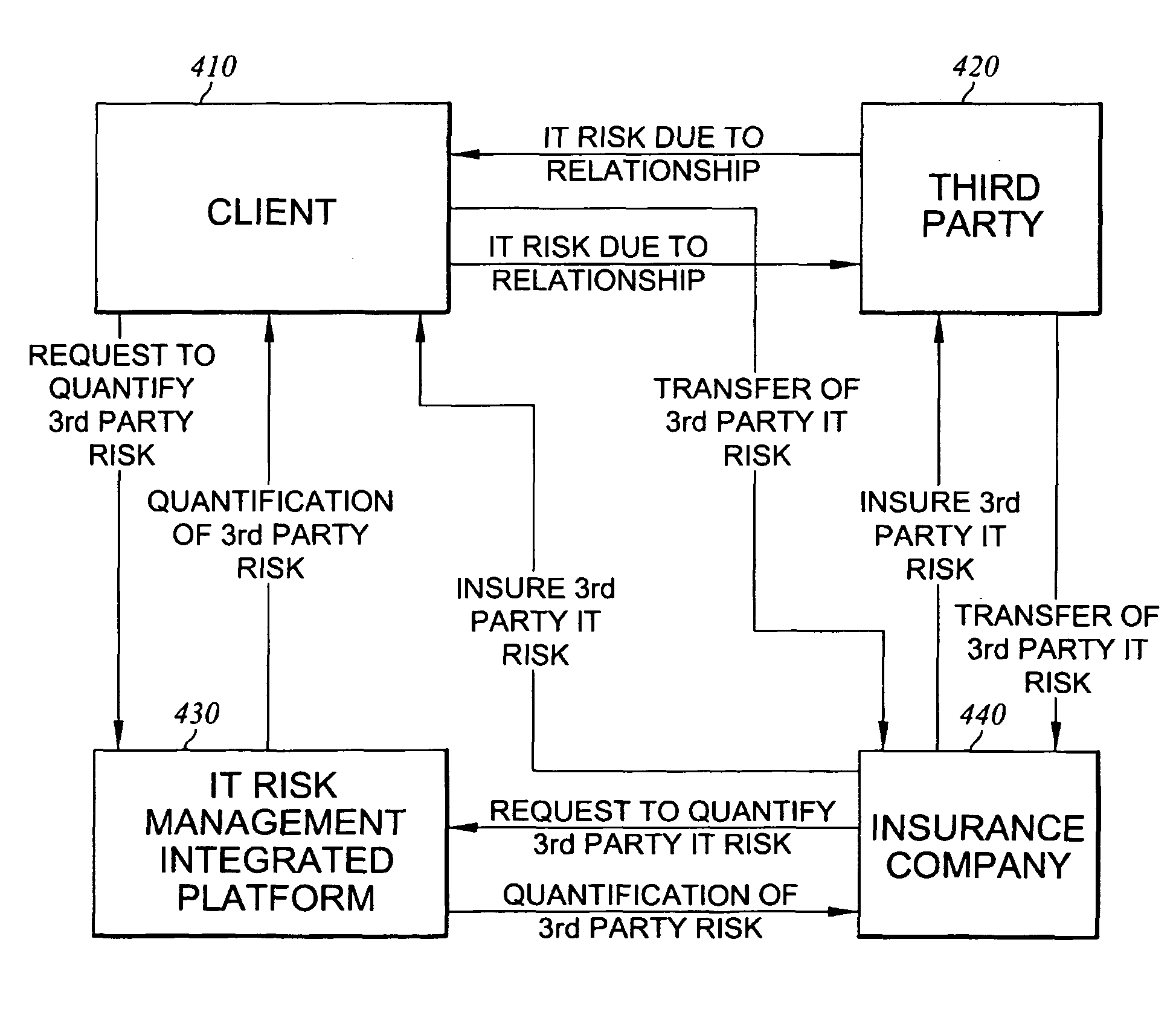

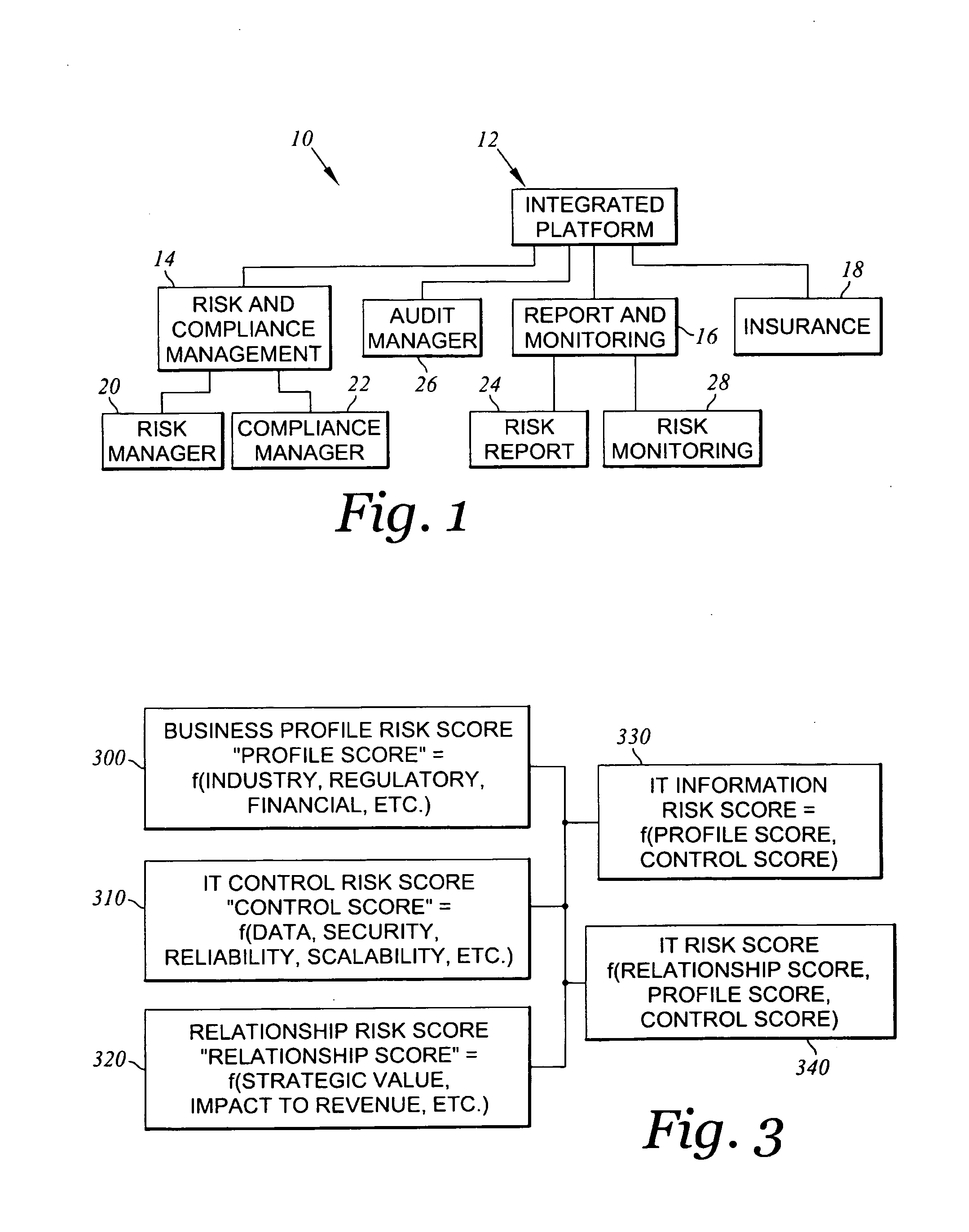

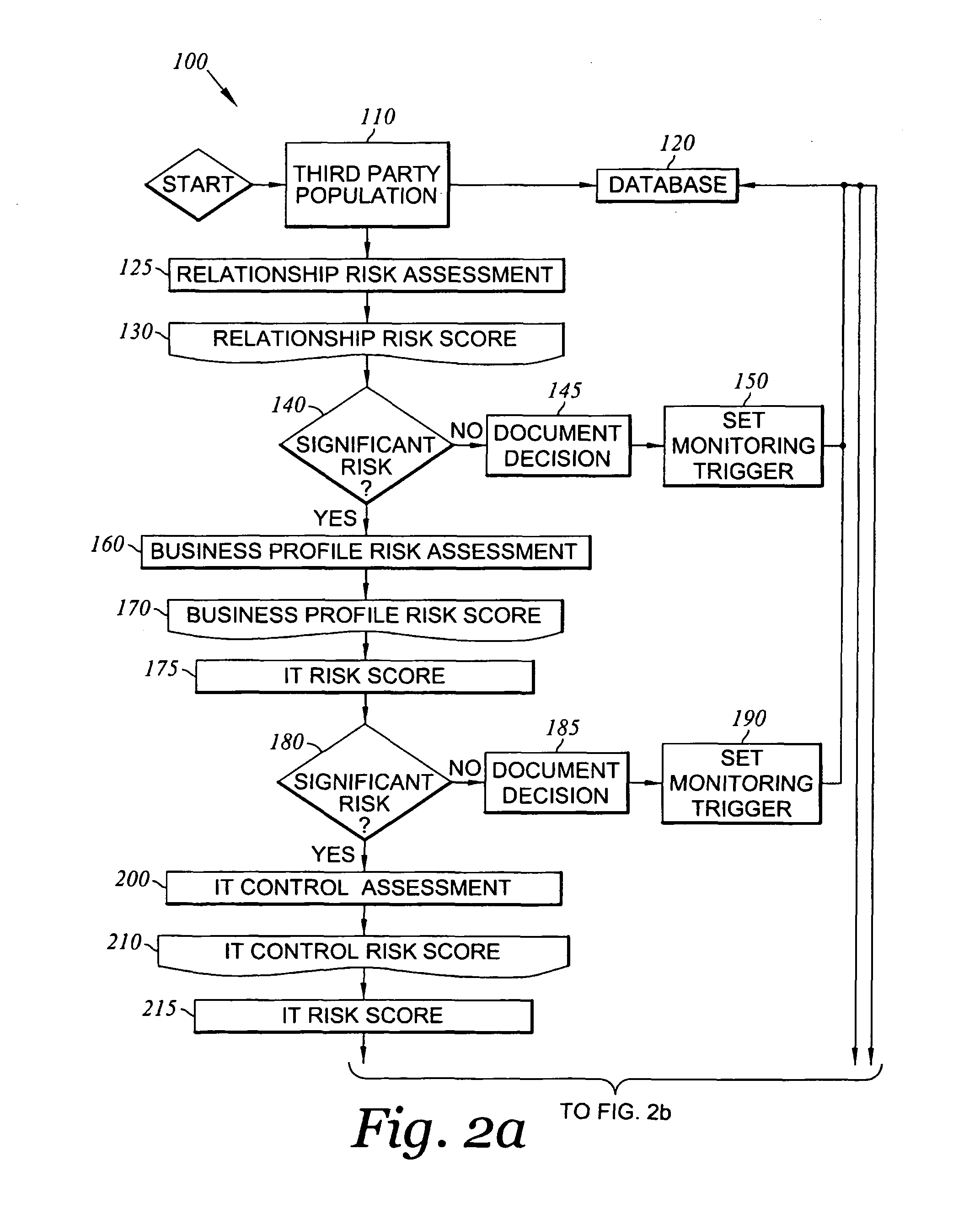

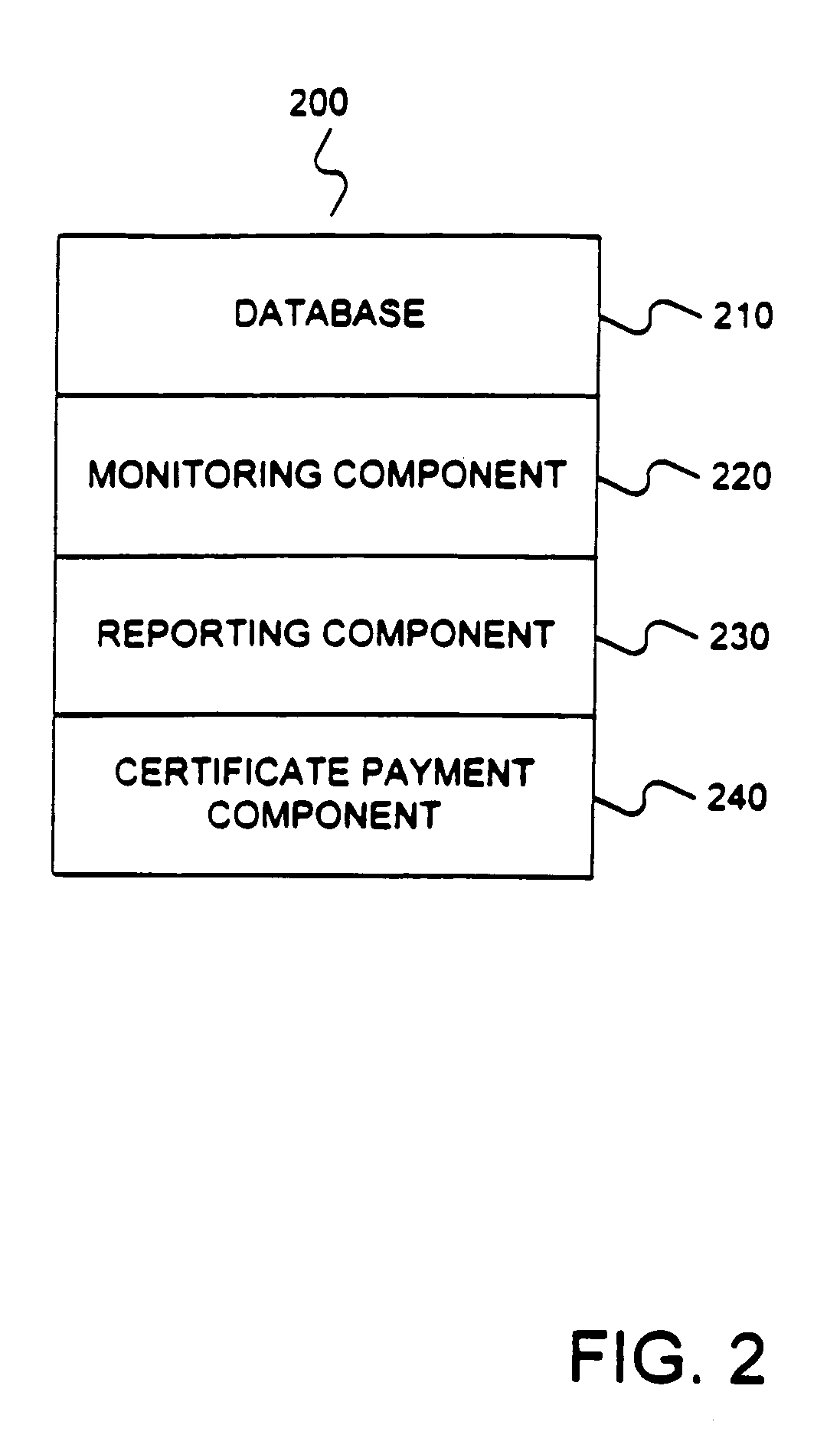

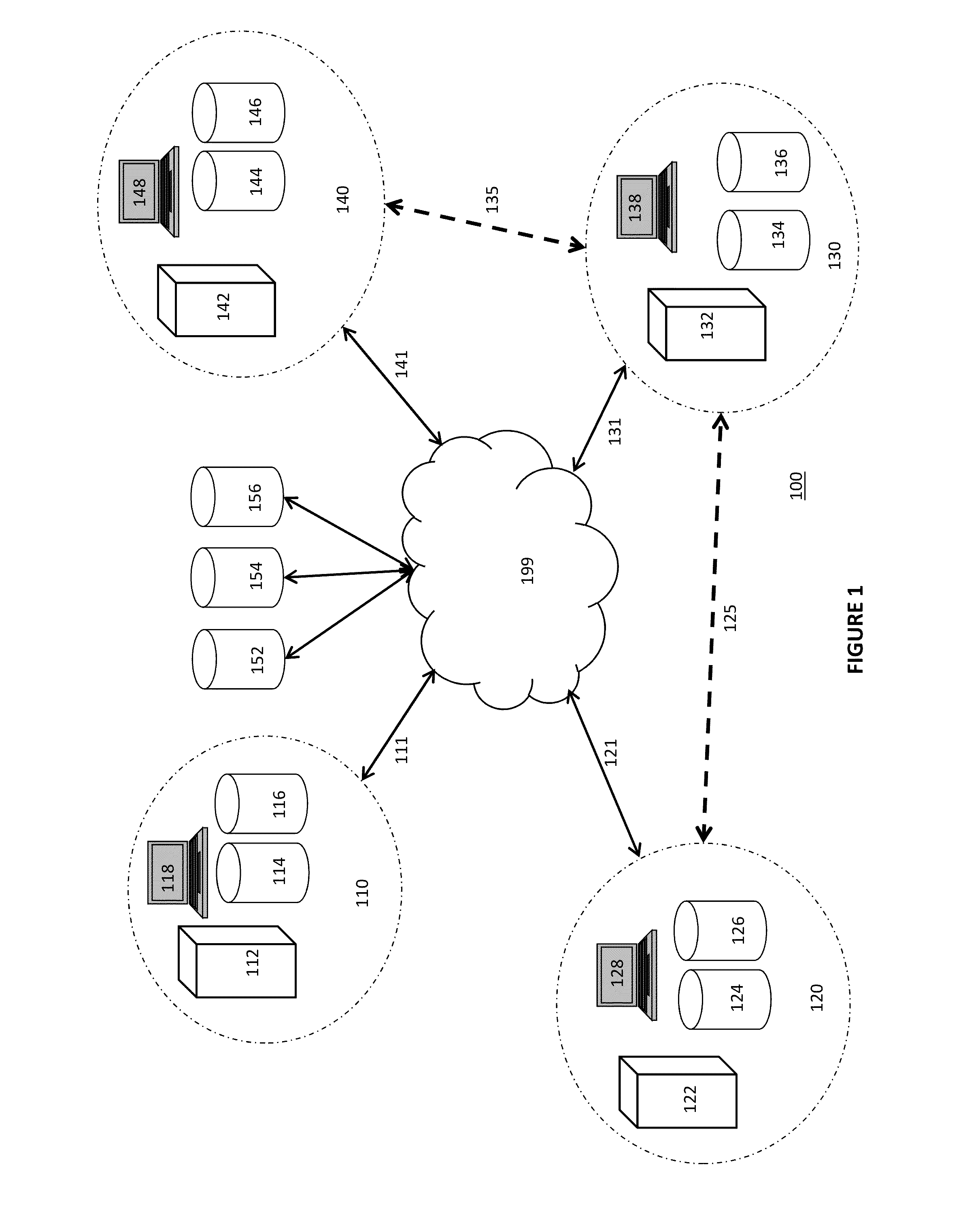

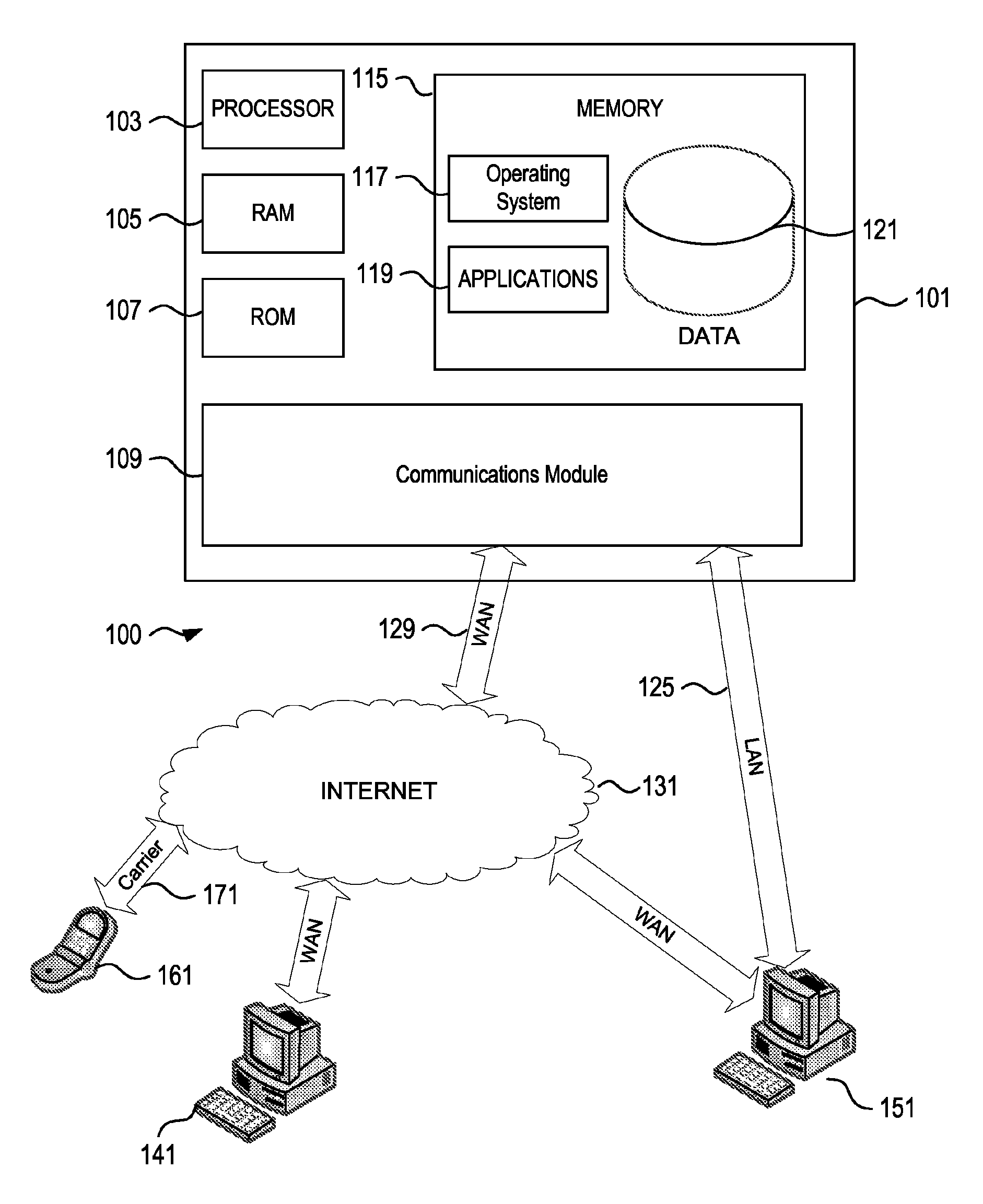

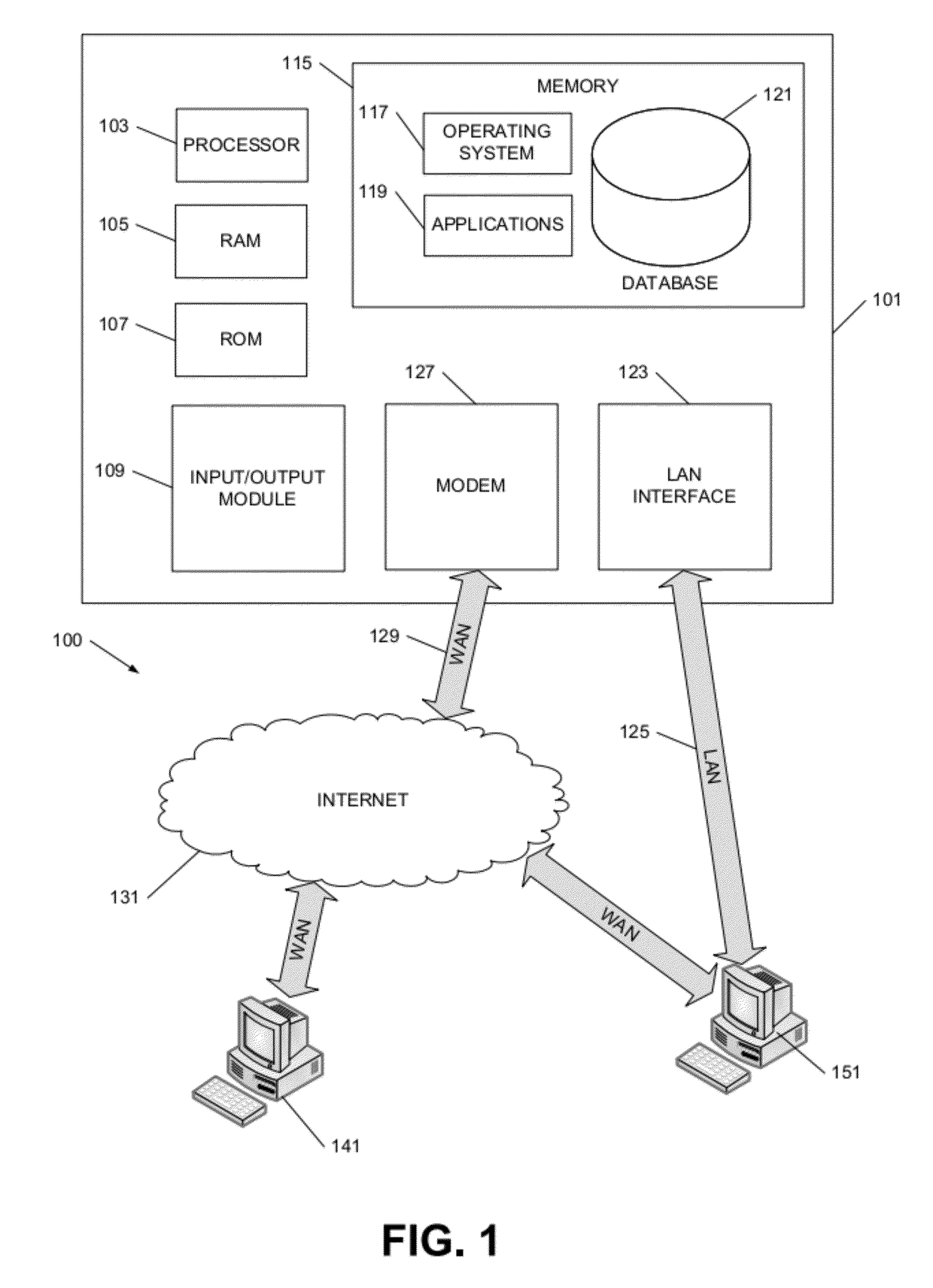

Method and system for assessing, managing, and monitoring information technology risk

A method for information technology (IT) and information asset risk assessment of a business relationship between a client and a third party. The method includes establishing a database. The database includes a plurality of IT information risk factors. The database is configured to receive IT risk information. The IT risk information is associated with the plurality of IT information risk factors. The plurality of IT information risk factors includes a subset of relationship risk factors. The subset of relationship risk factors are utilized for evaluating the business relationship risk between the client and the third party. The method also includes receiving IT risk information corresponding to the subset of relationship risk factors. The method continues with generating a relationship risk score. The relationship risk score is determined in response to evaluating the subset of relationship risk factors using the IT risk information corresponding to the subset of relationship risk factors.

Owner:OPTIV SECURITY INC

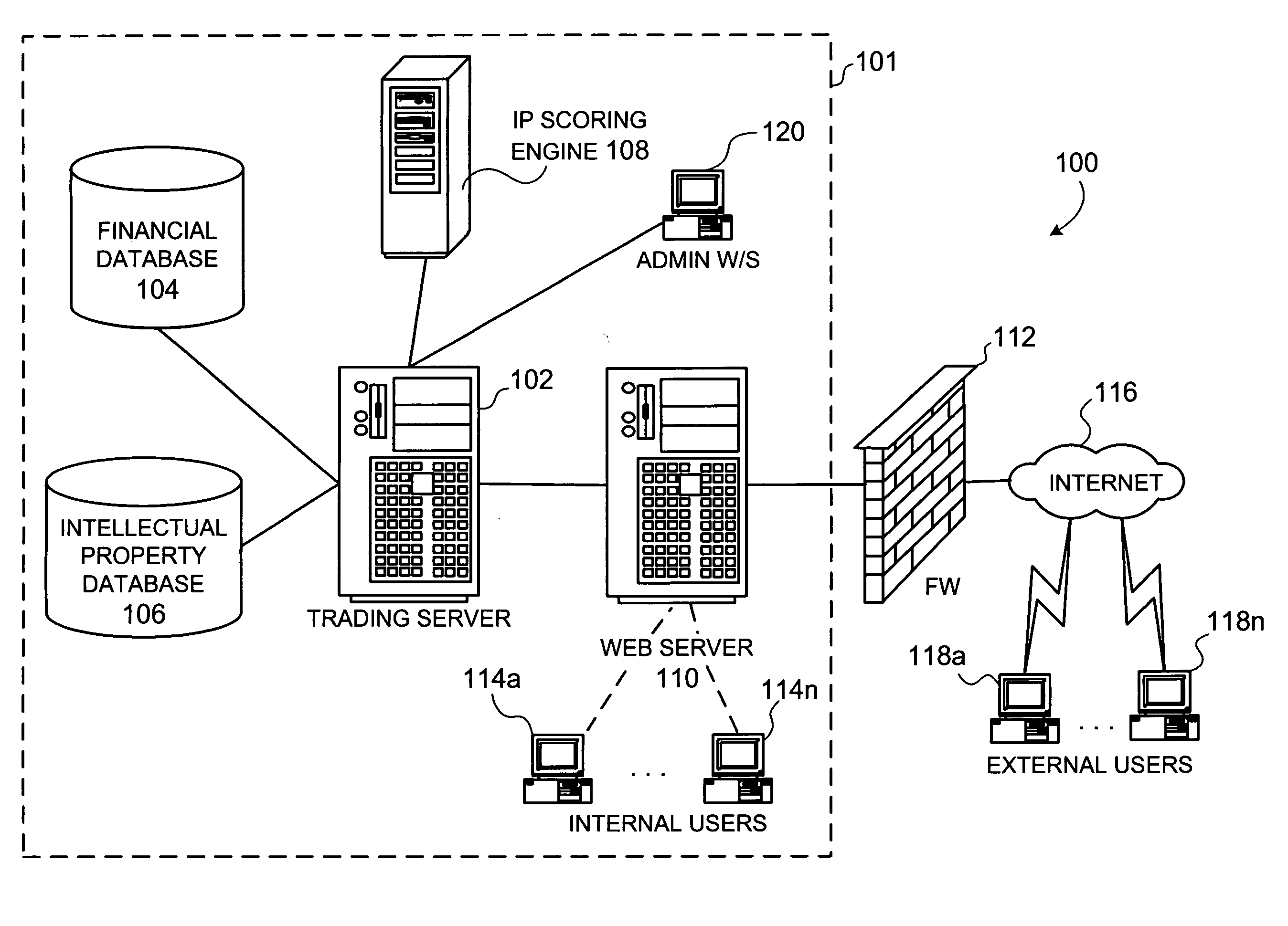

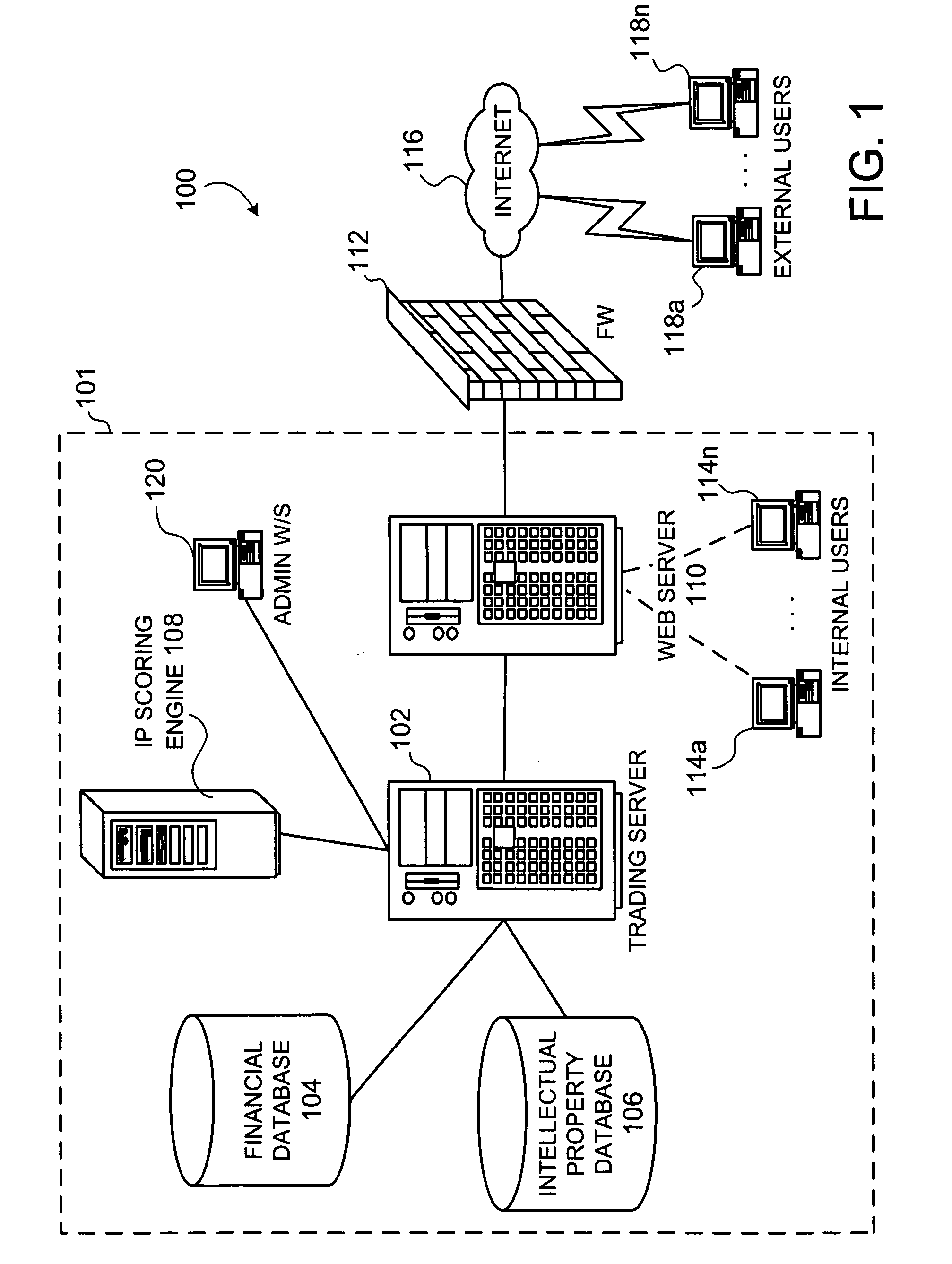

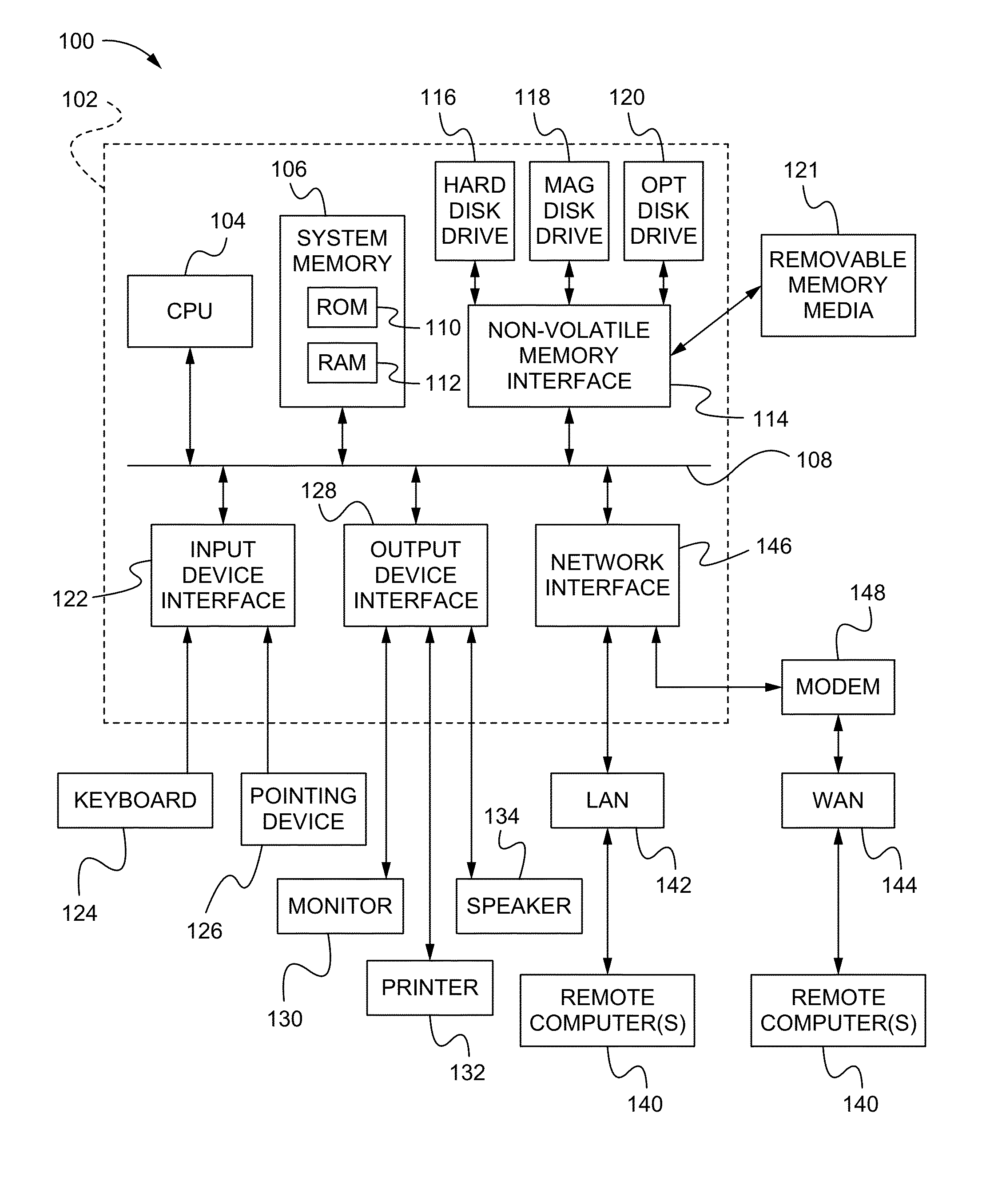

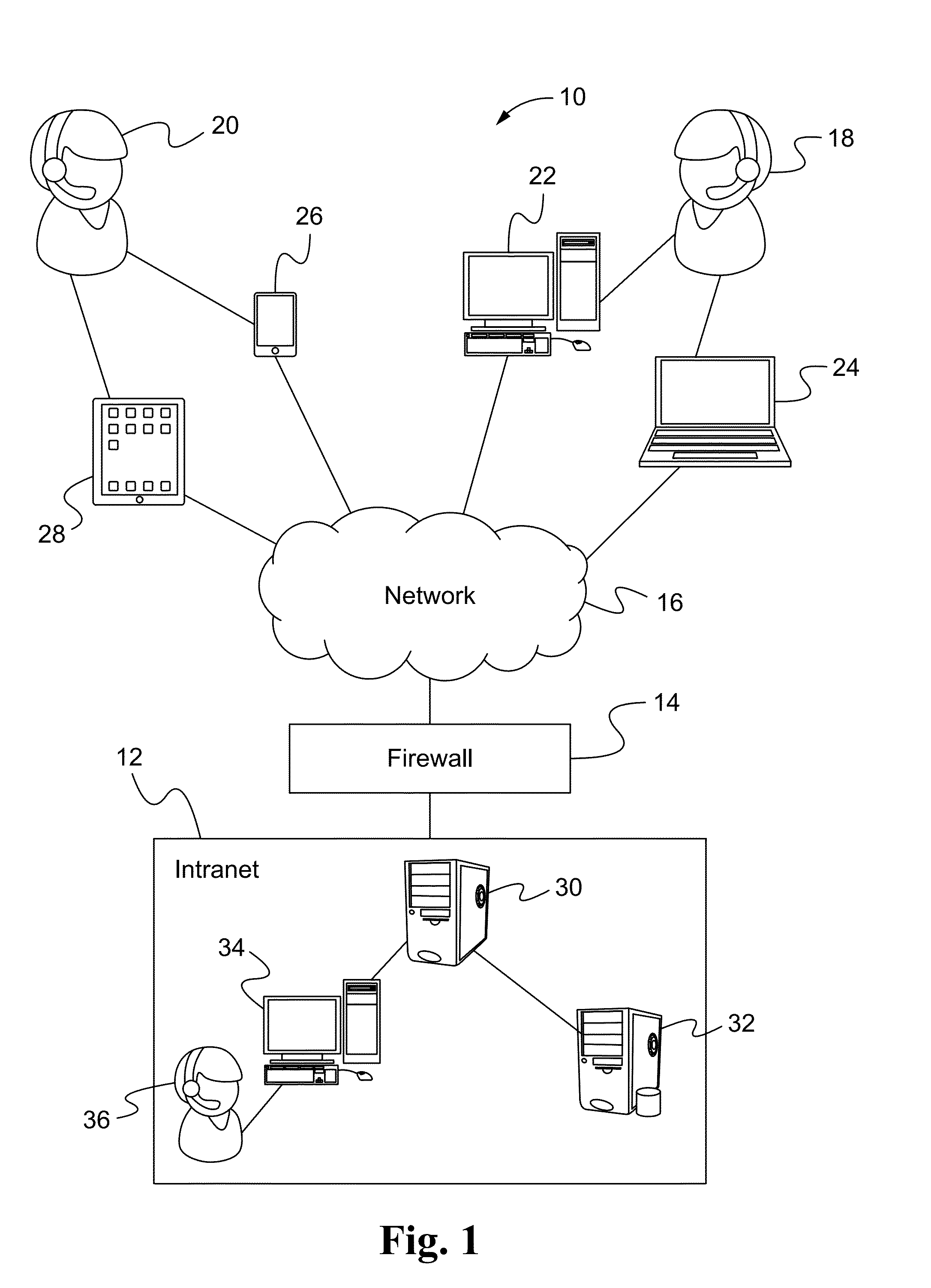

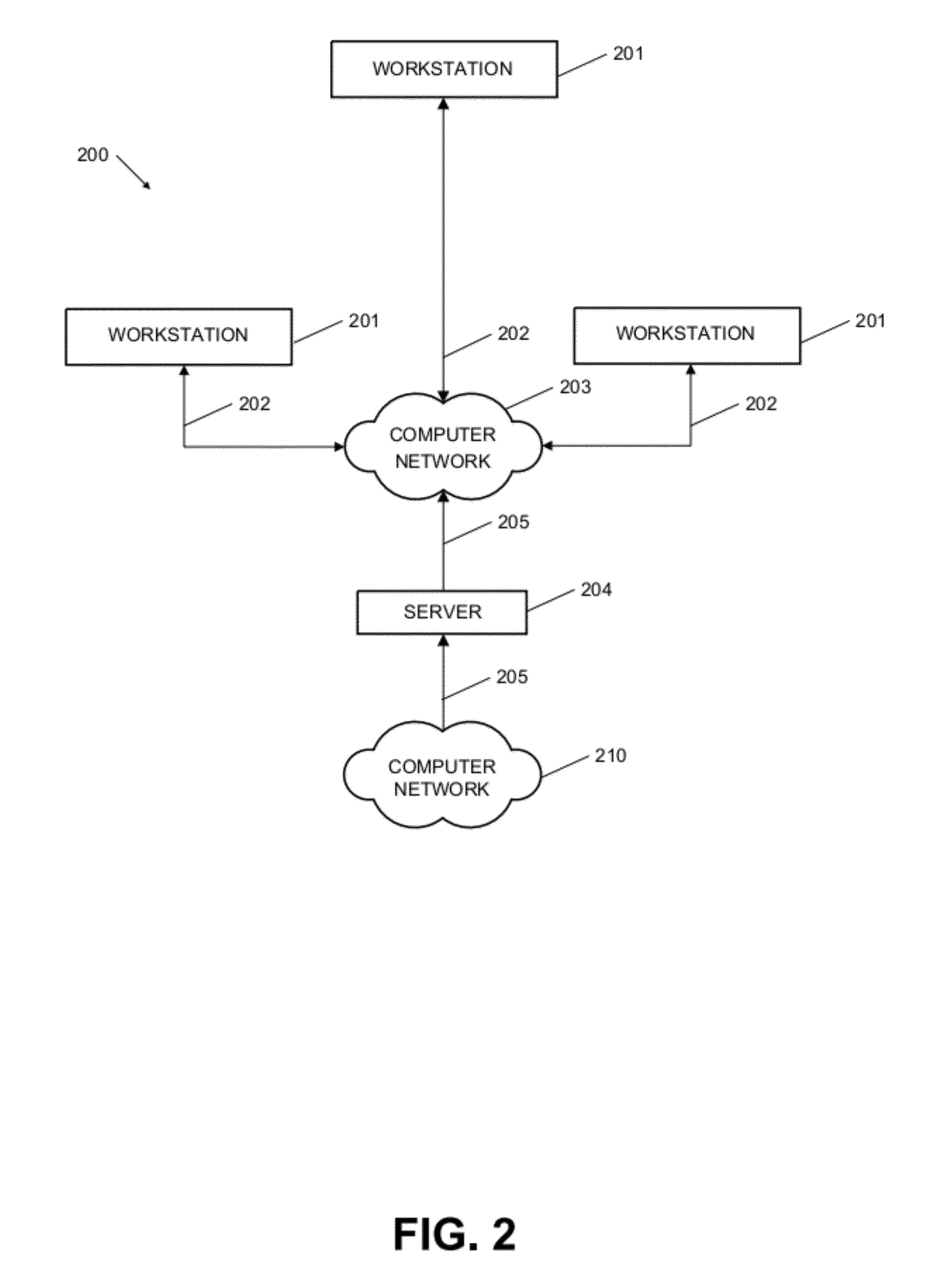

Methods for creating and valuating intellectual property rights-based financial instruments

InactiveUS20060100948A1Enhanced and advantageous methodBetter hedgingFinanceGraphicsGraphical user interface

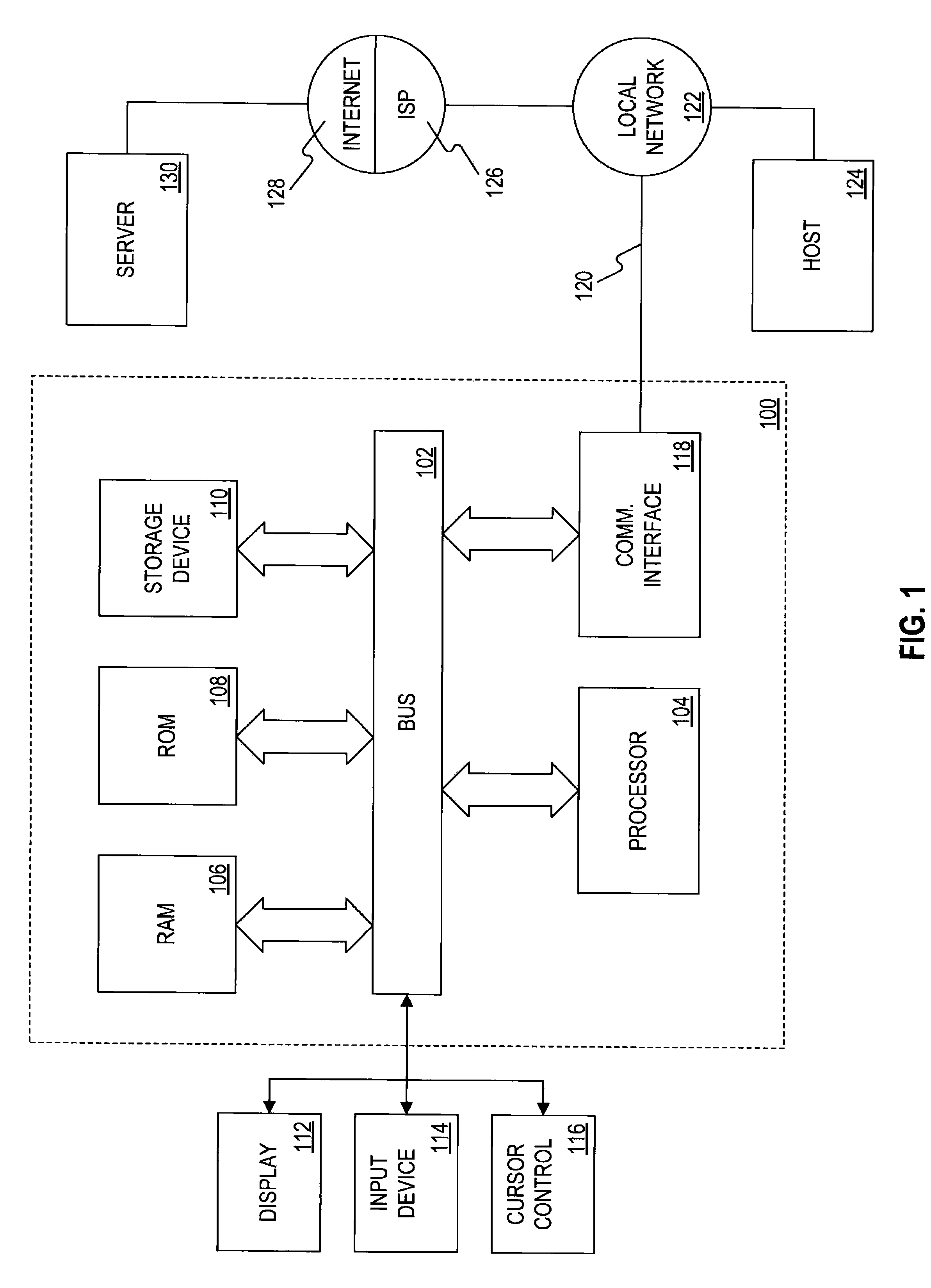

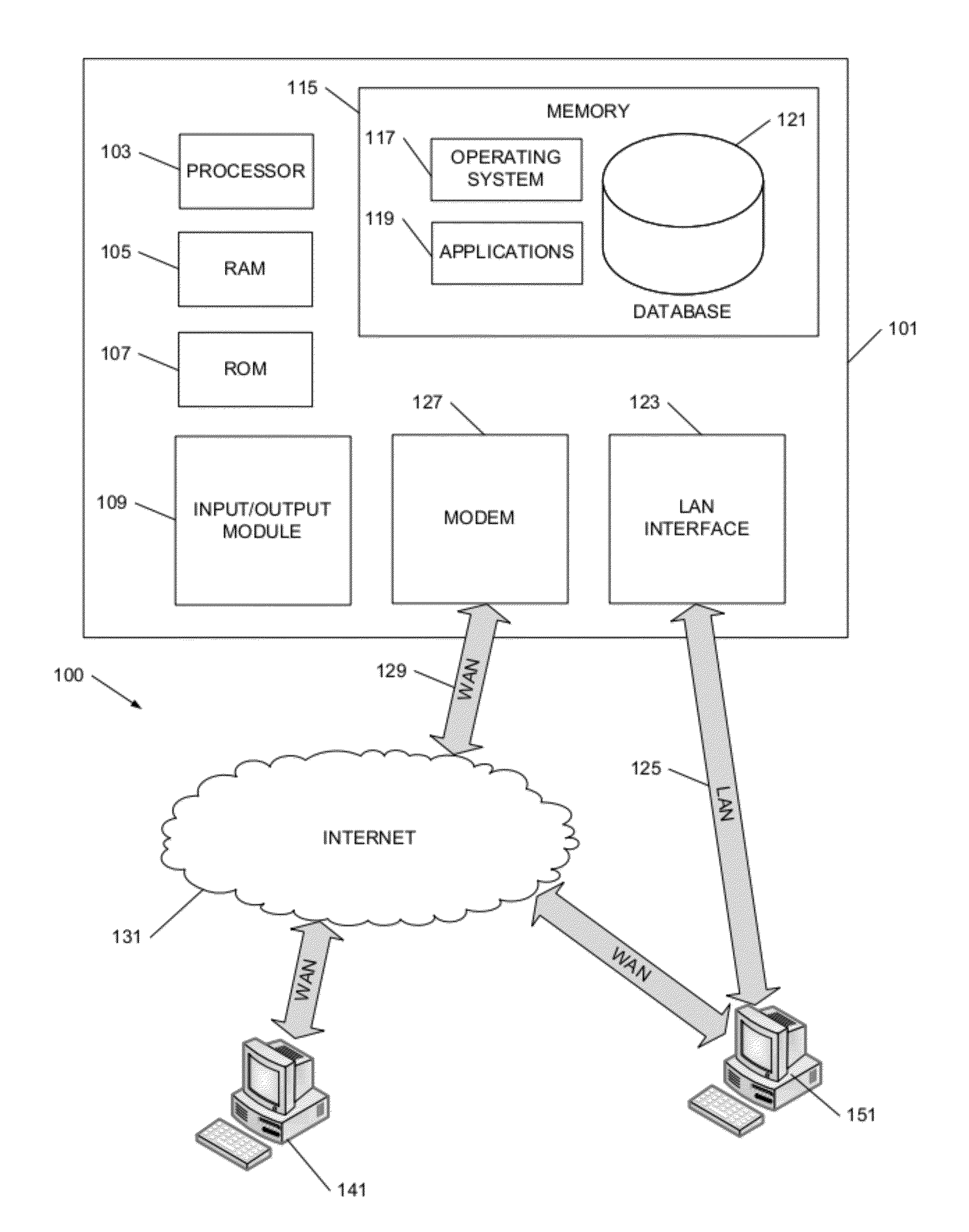

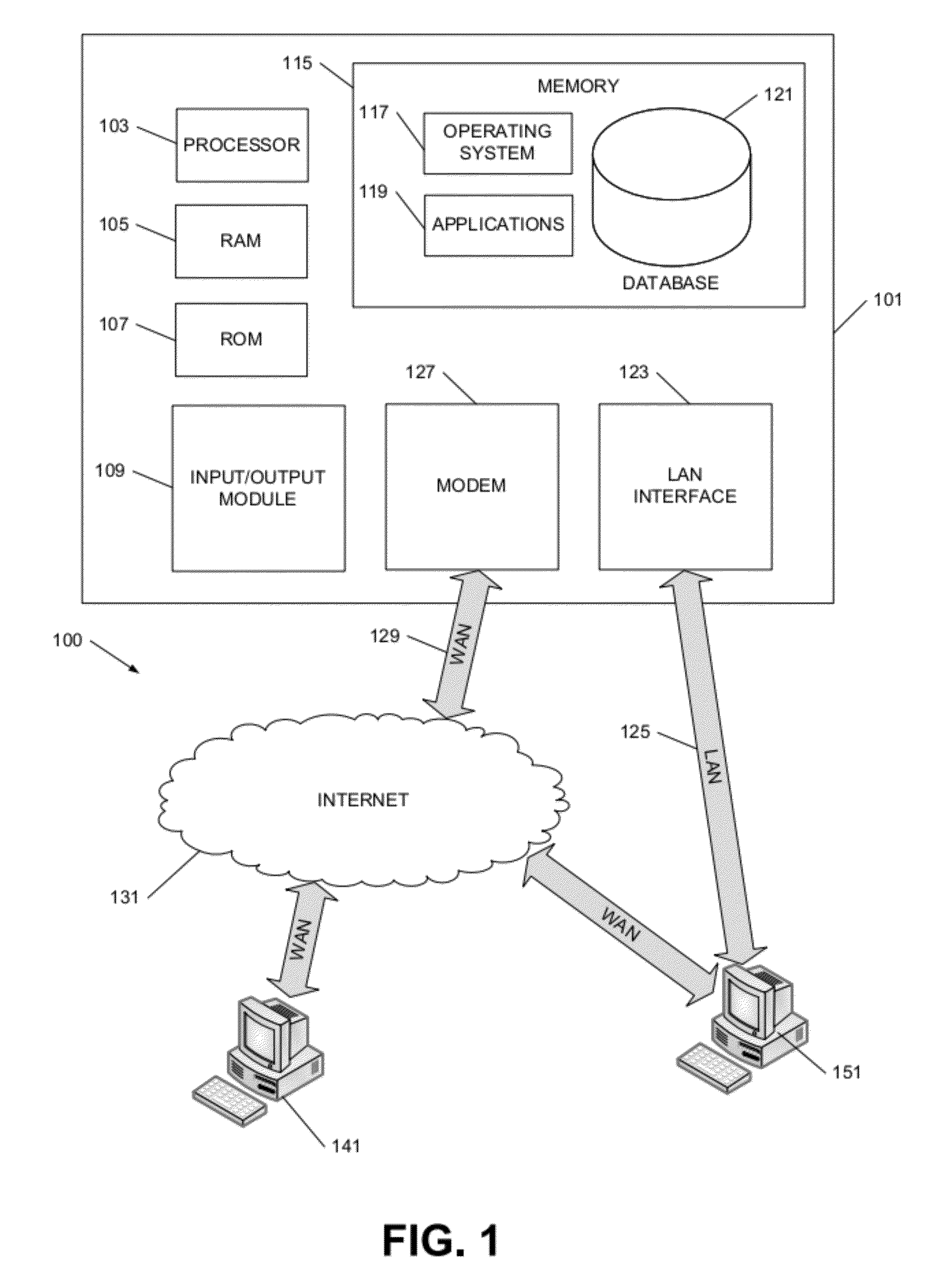

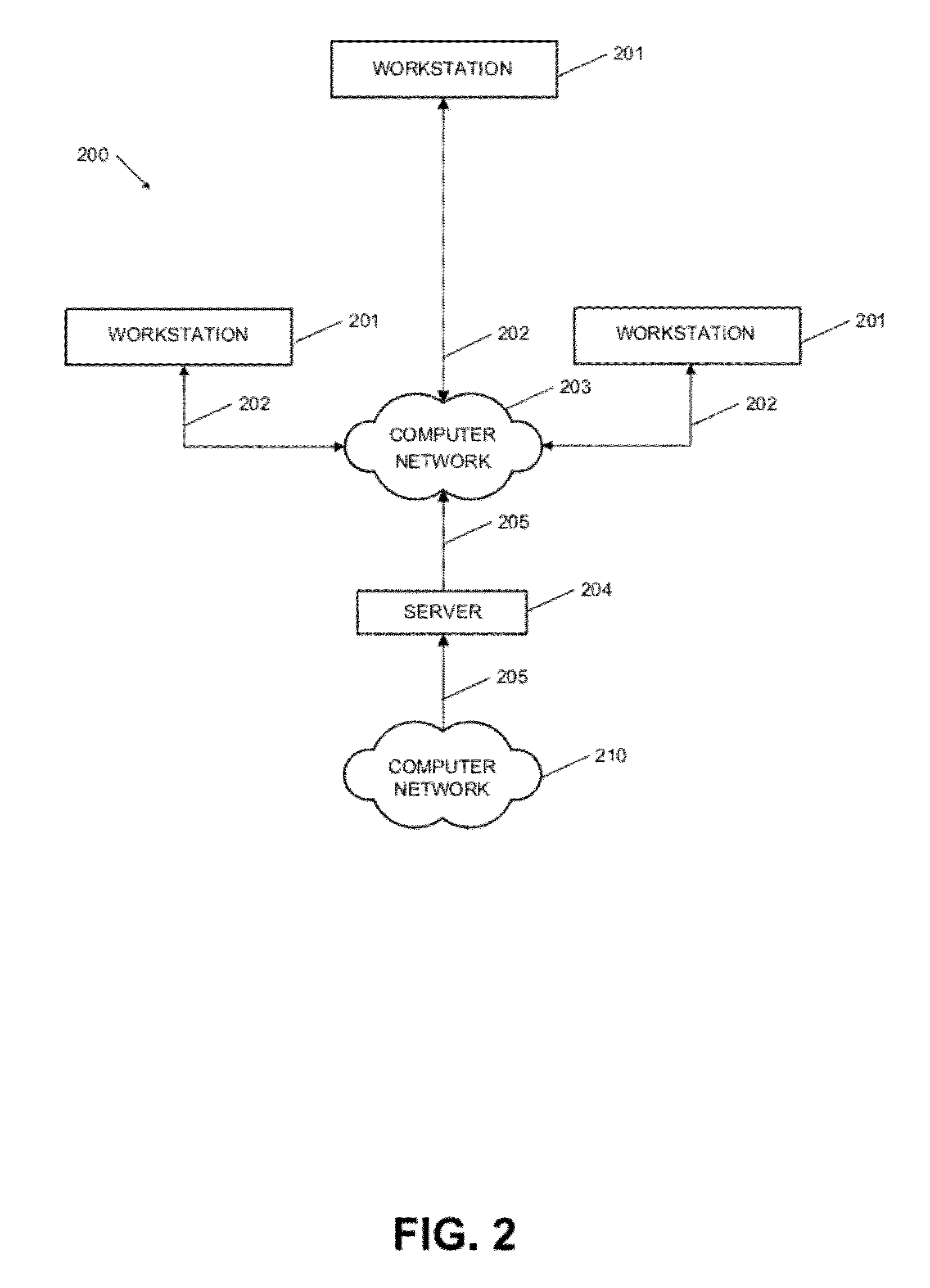

Systems, methods and computer program products for creating and valuating intellectual property rights-based financial instruments, including patent futures, options, swaps, and the like, are disclosed. In an embodiment, the present invention provides a “patent derivative” to allow investors (e.g., venture capitalist) to hedge their risk in investing in a high-technology, start-up company with no issued patents, but with one or more pending patent applications. The system includes databases for IP rights and financial information, as well as a central processing trading server that is accessible via internal and external workstations. The workstations provide a graphical user interface to enter a series of inputs and receive information (i.e., output) concerning such a financial instrument. The method and computer program product involve collecting the series of inputs affecting the value of the financial instrument and applying a pricing model modified to account for some aspect of potential intellectual property (e.g., patent) rights.

Owner:RAYMOND MILLIEN

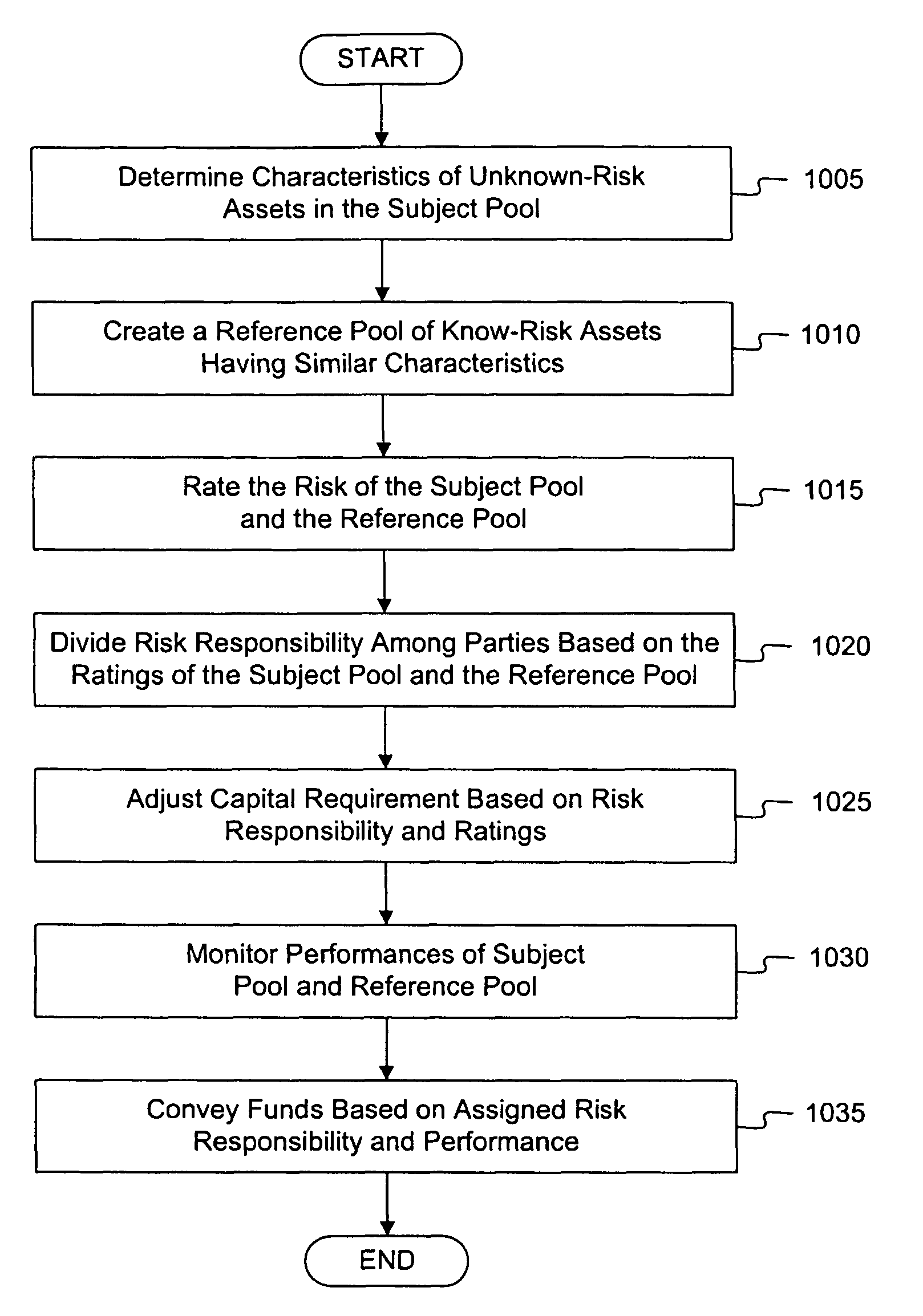

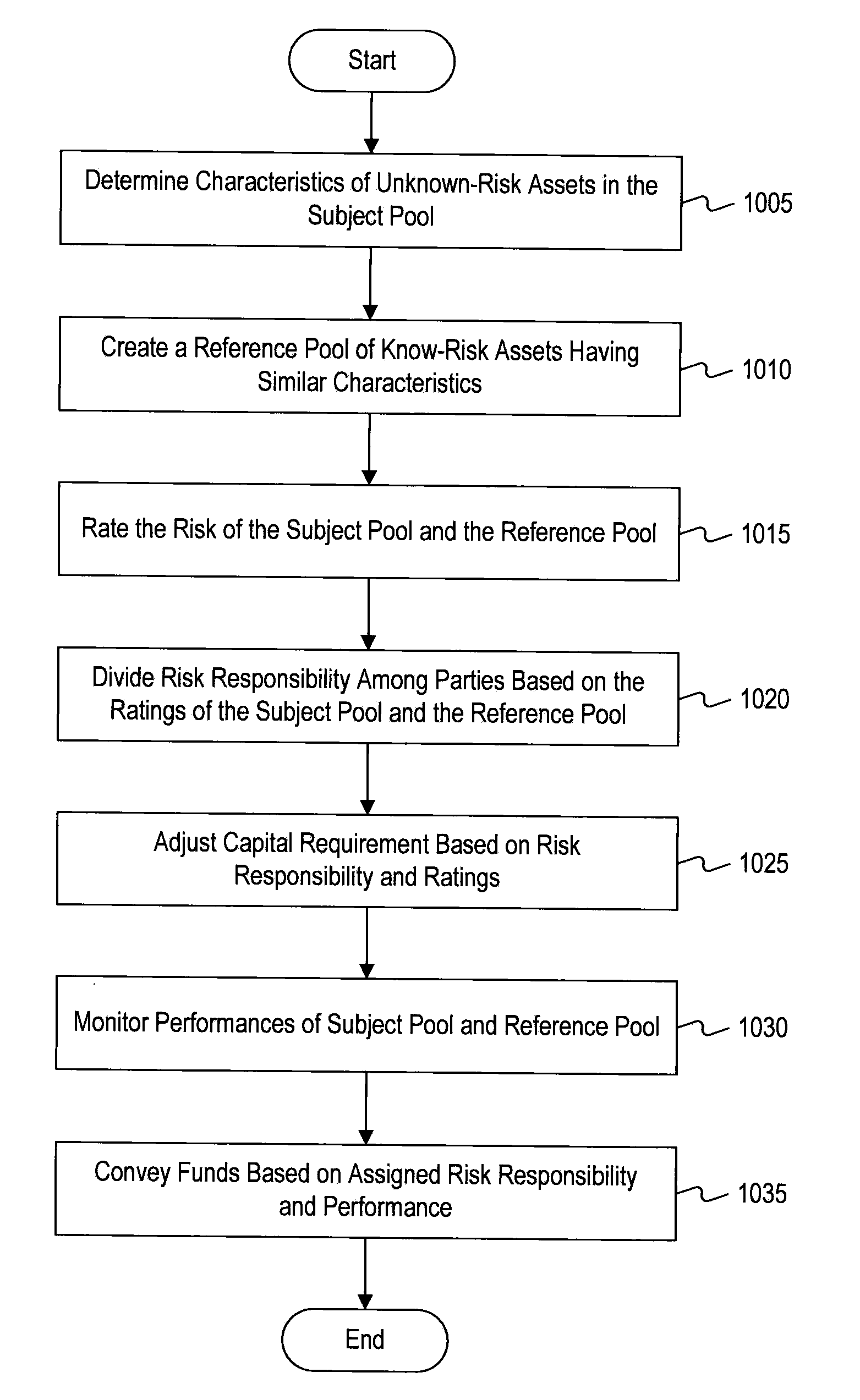

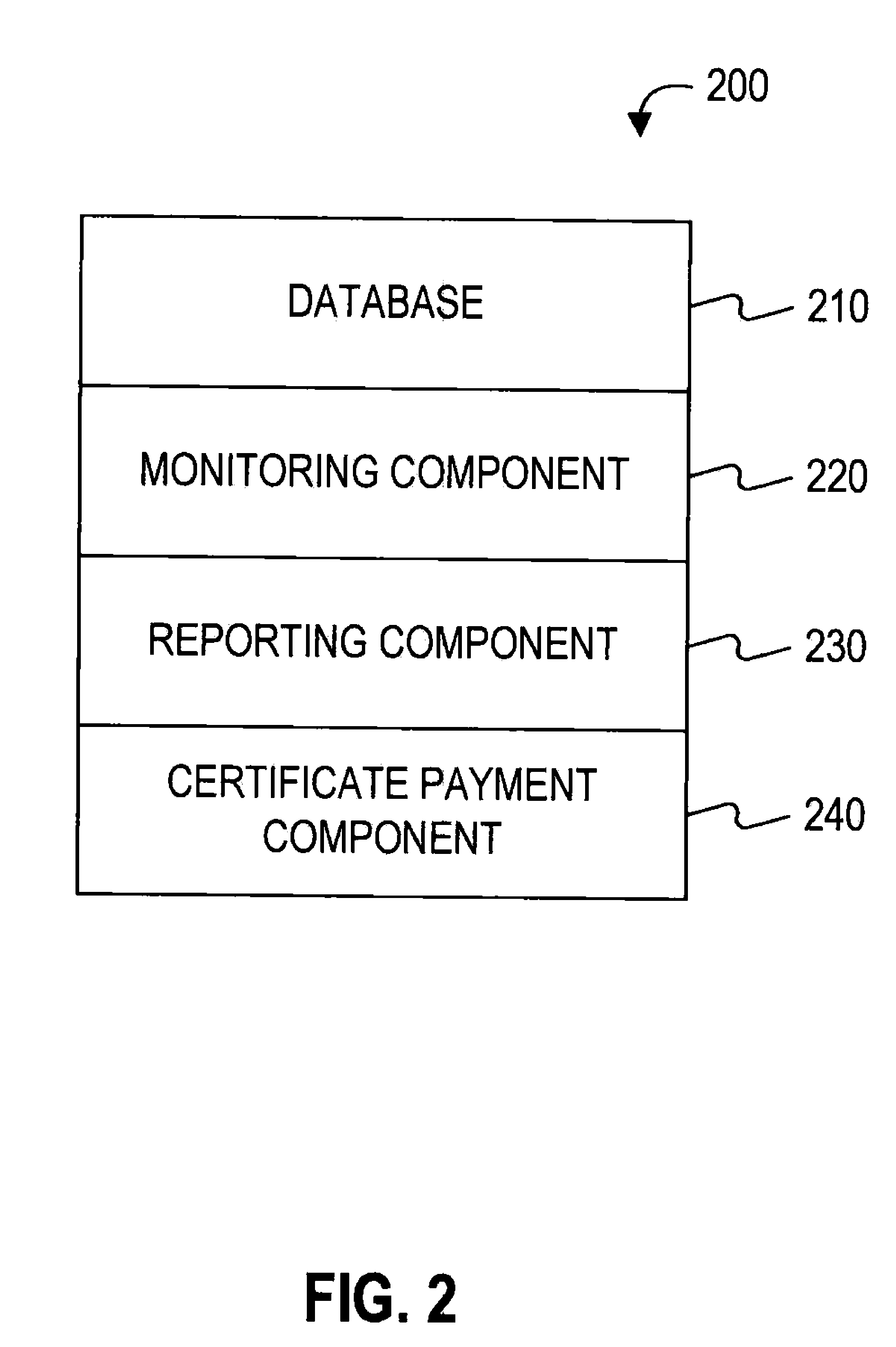

Risk-based reference pool capital reducing systems and methods

Embodiments consistent with the present invention provide a credit enhancement structure for risk allocation between parties that minimizes the regulatory capital reserve requirement impact to an institution subject to capital reserve requirement. A subject pool of assets held by the institution, such as a pool of loans, is rated to determine its risk levels. Based on the rated risk levels, a guarantor party agrees to be responsible for a portion of the risk associated with the pool of assets, which may define the maximum risk exposure of the institution holding the asset pool. The risk-rated capital reserve requirements are applied to the asset pool based on the risk level rating and the guarantor's agreed upon risk responsibility such that the institution holds a reduced amount of reserve capital compared to what it would otherwise be required to hold.

Owner:HEUER JOAN D +6

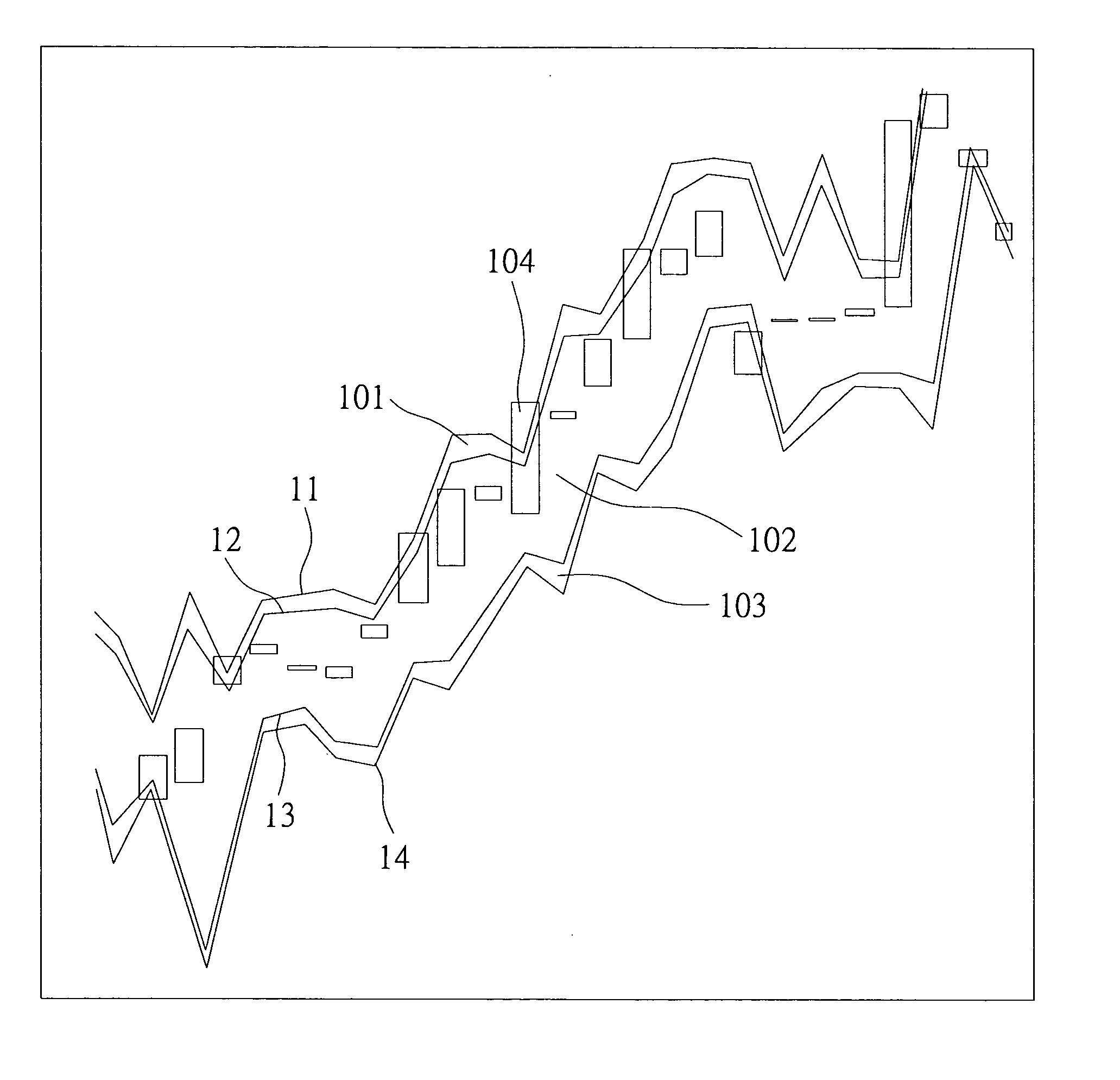

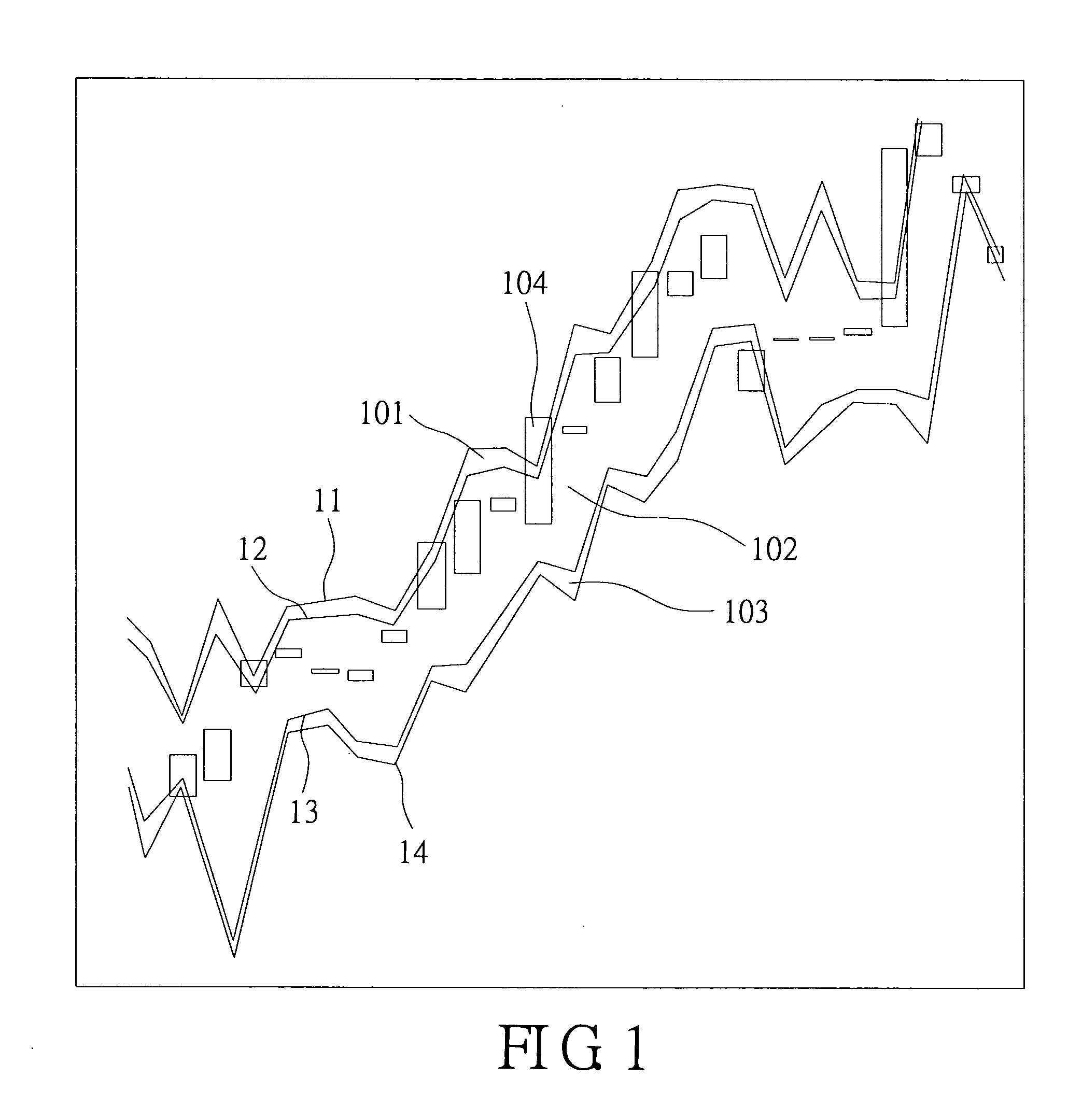

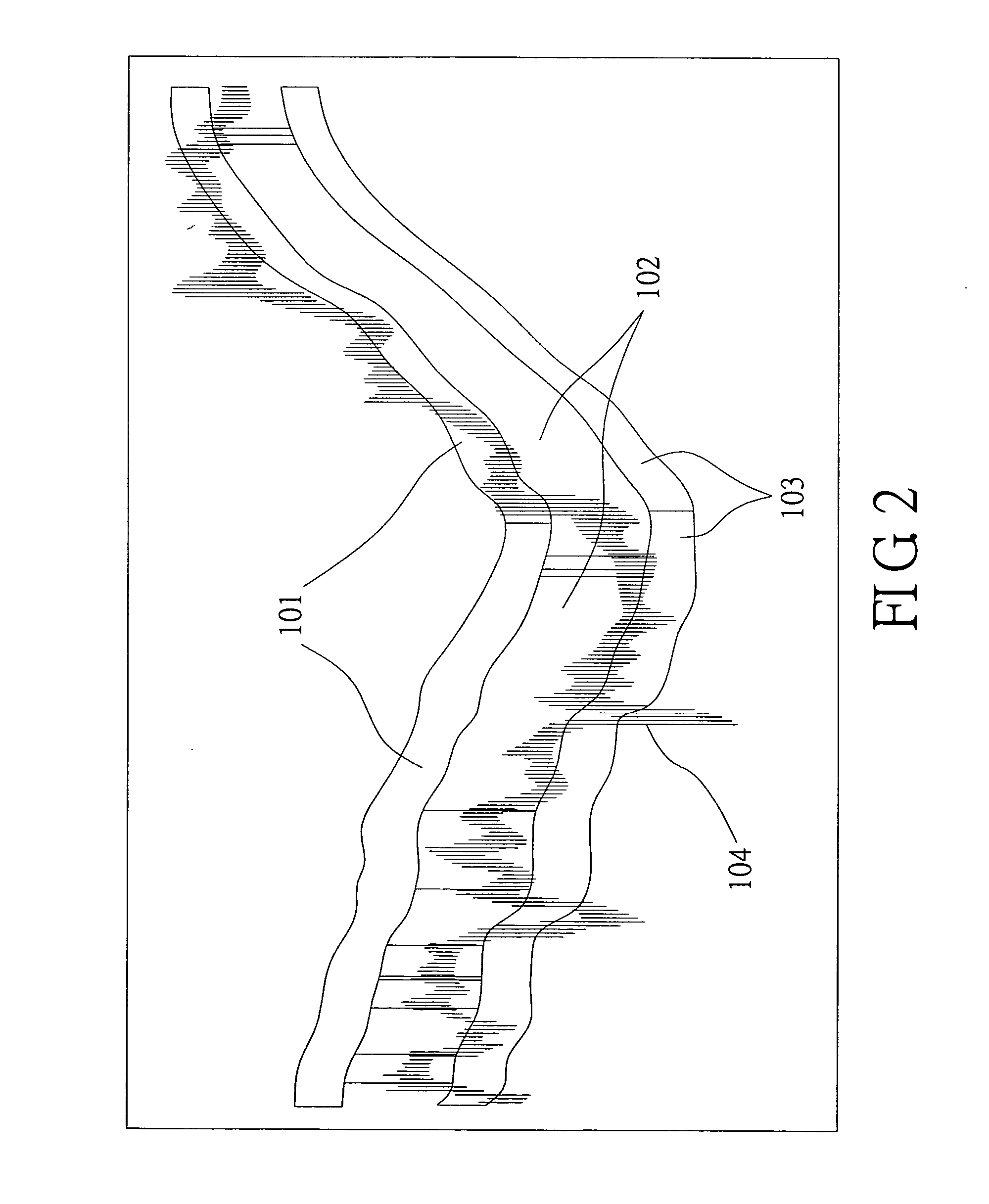

Method for analyzing financial stock market trend

InactiveUS20070168269A1Improve accuracyPromote investor 's profitFinanceData miningIntermediate term

Owner:CHUO KUO YU

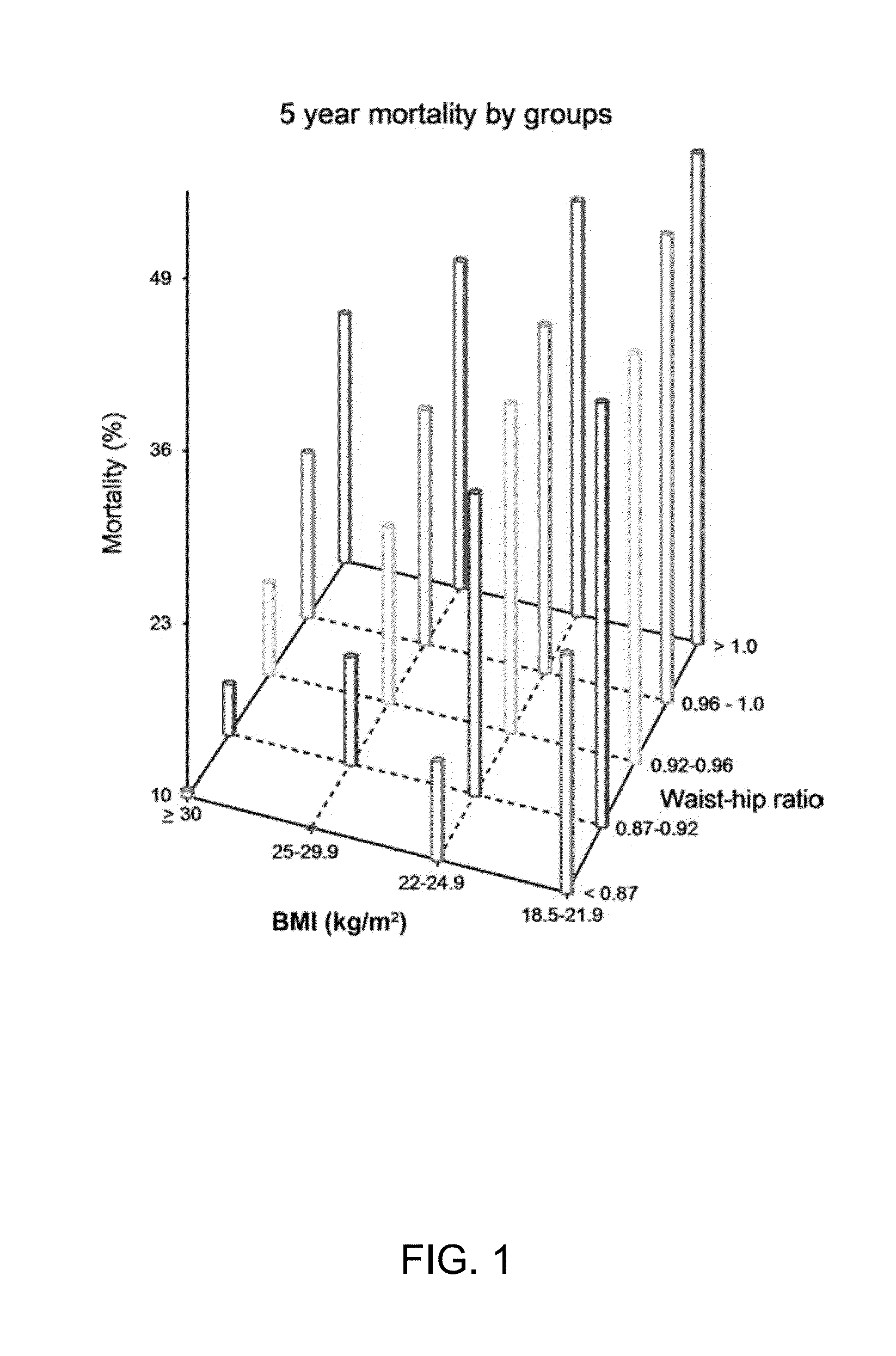

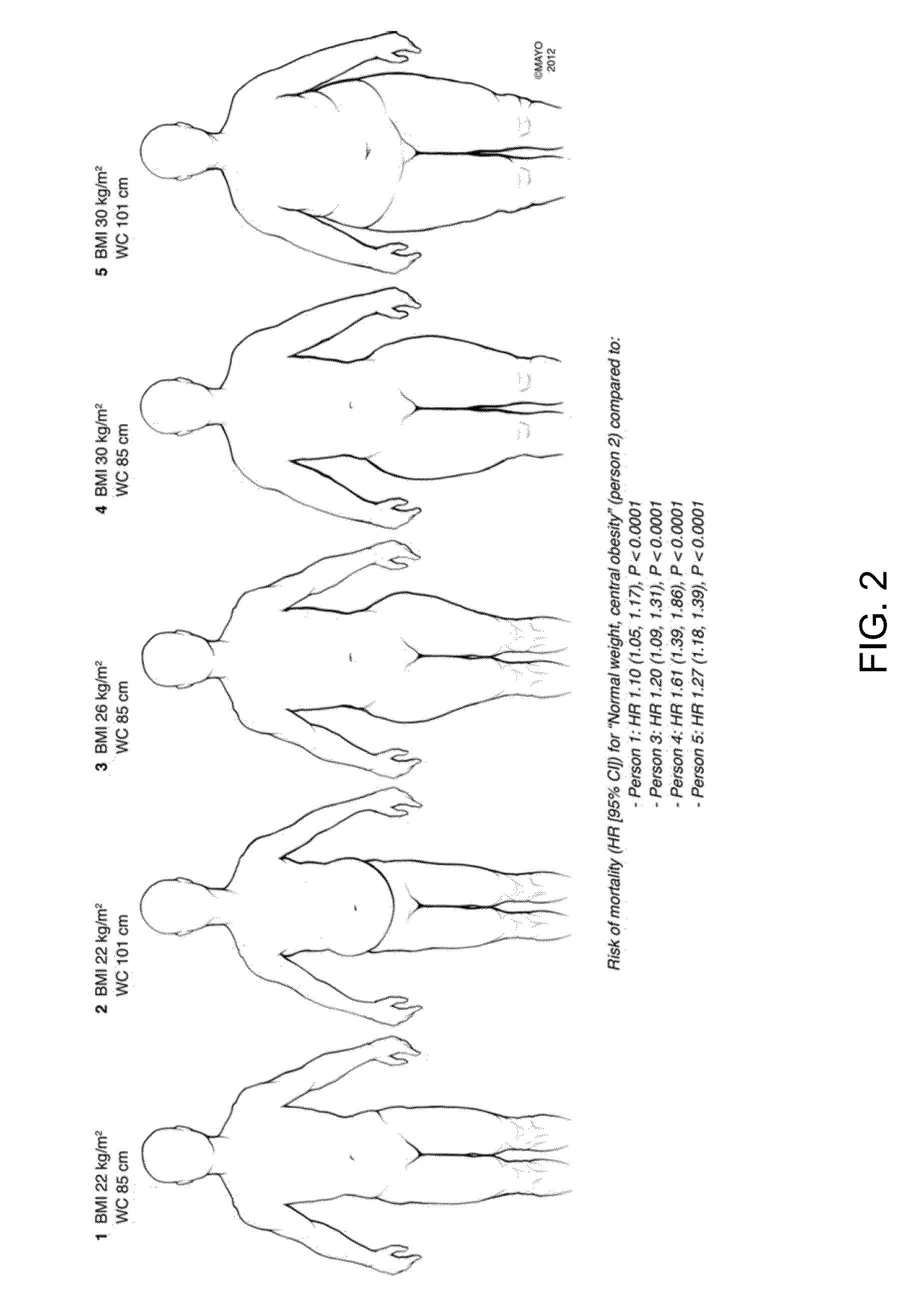

Systems and methods for developing and implementing personalized health and wellness programs

InactiveUS20140088996A1High correlationGood for healthMedical communicationPhysical therapies and activitiesDashboardGraphics

User-specific medical, genetic, fitness, environmental and nutritional data is collected to develop personalized health and wellness programs for improving a user's health and wellness. The user-specific data may be collected from medical or genetic tests, mobile health devices worn by the user and applications through which the user manually inputs information. The user-specific data is then collected and analyzed together based on knowledge of the interrelationships between medical, genetic, fitness, environmental and nutrition data to develop a comprehensive user profile and personalized health and wellness programs that are targeted to improving specific areas of the user's health by implementing changes in fitness, nutrition, medical treatment, environment, etc. The user is provided with a customizable, interactive dashboard graphical user interface of their current health and wellness data, which, along with notifications, incentives and rewards, helps the user improve their overall health and wellness and significantly reduce their risk of morbidity.

Owner:MD REVOLUTION

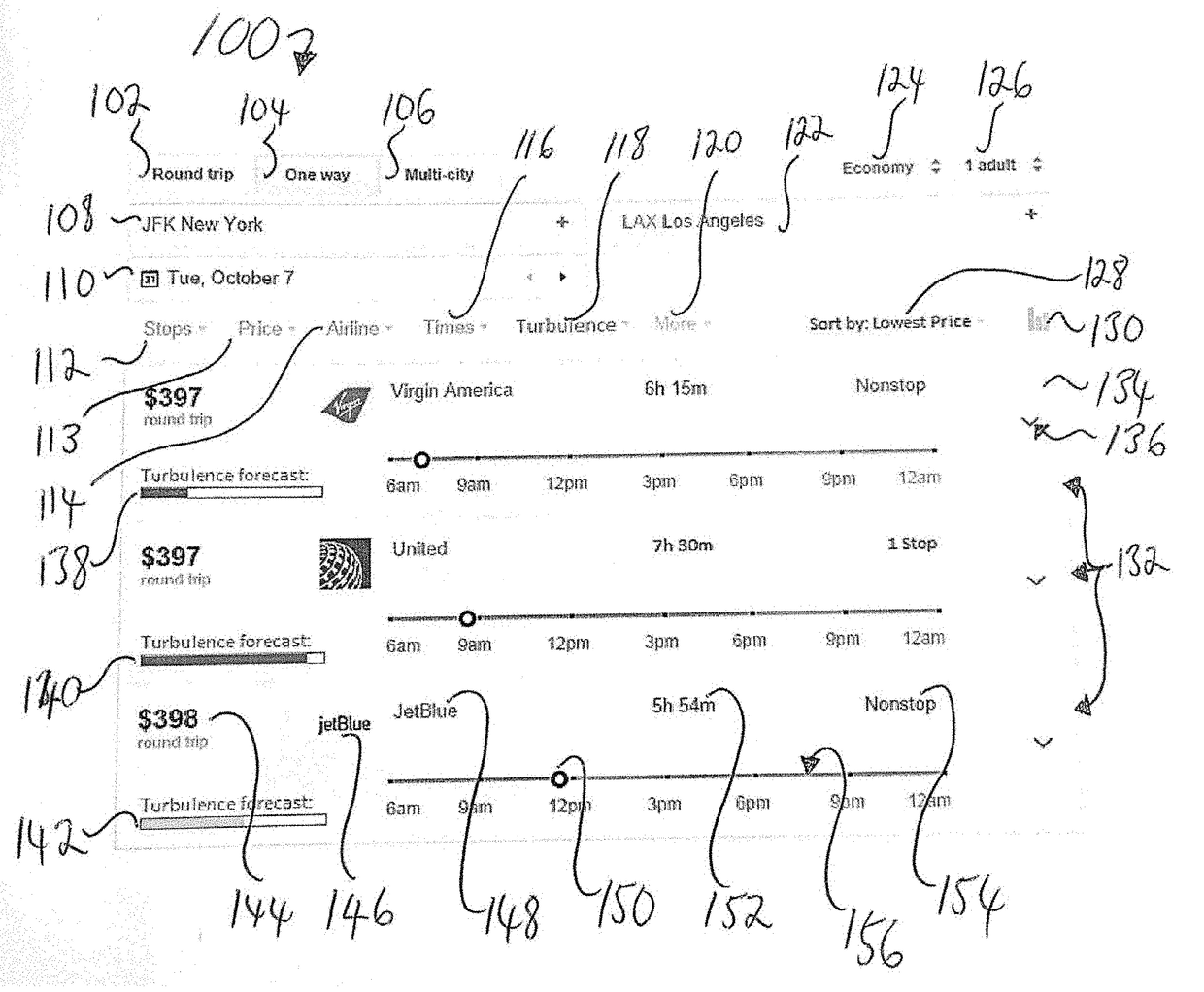

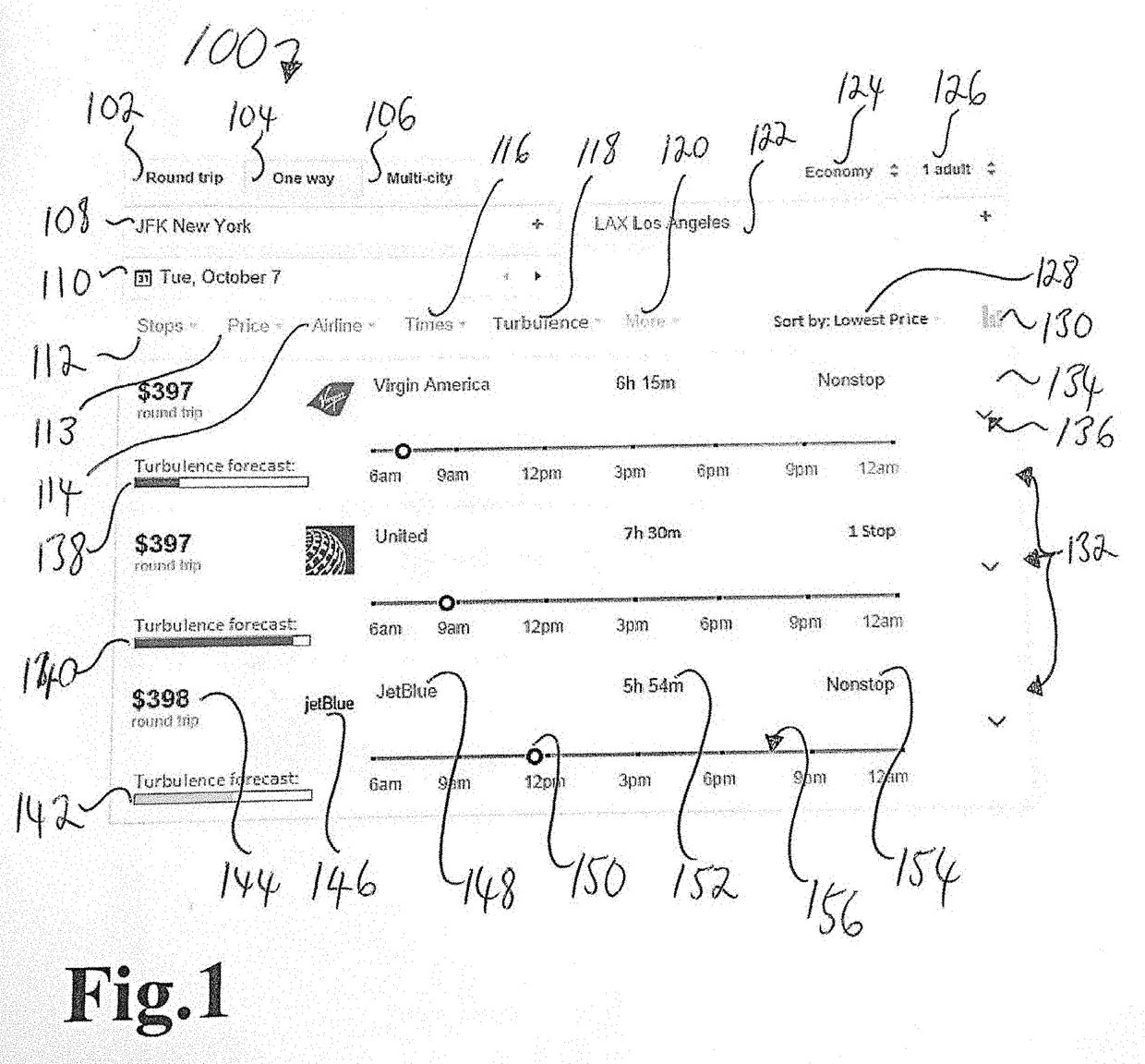

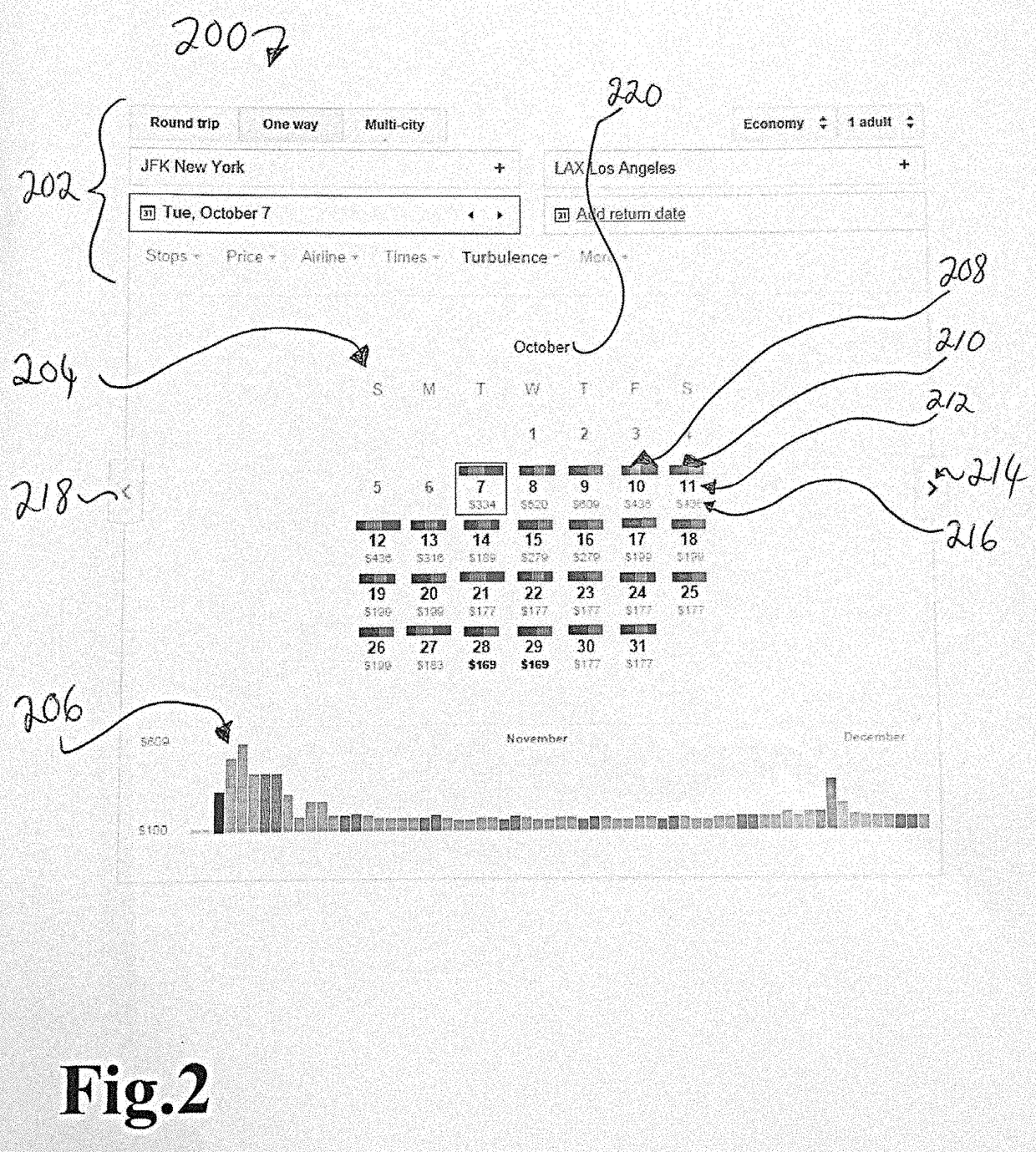

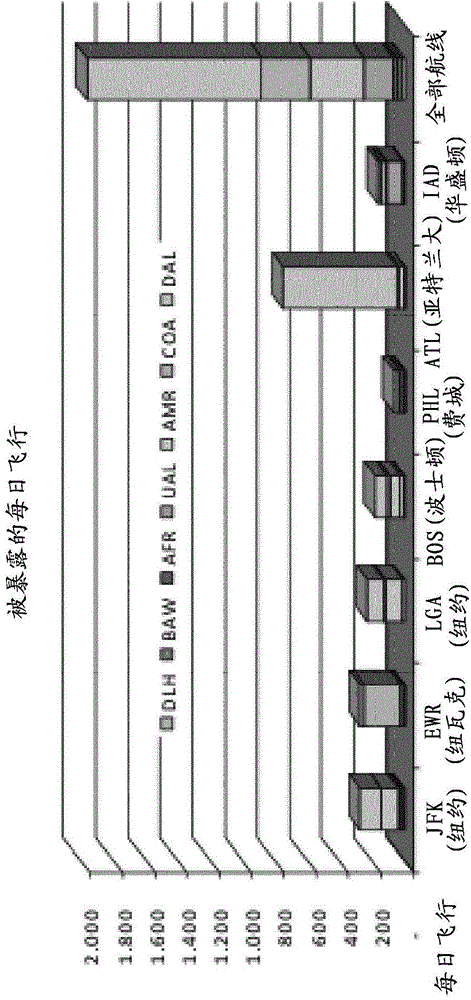

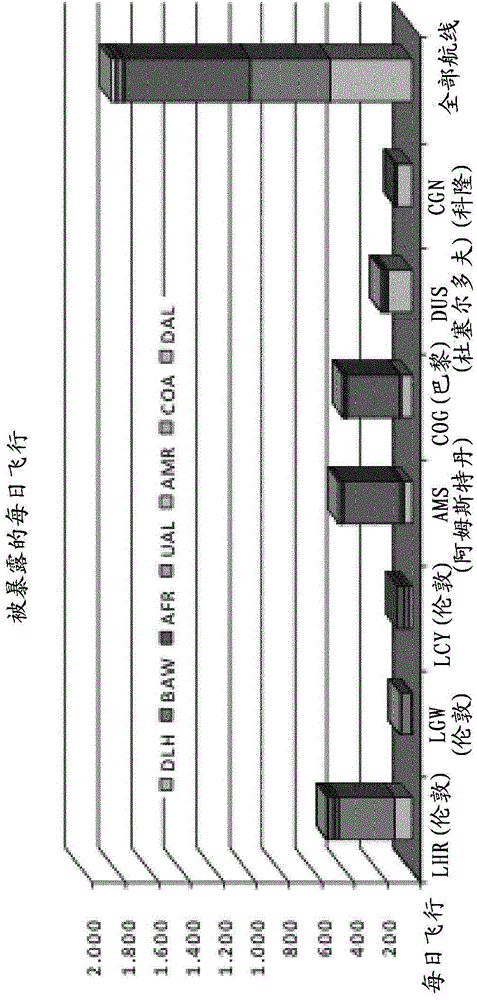

Flight Safety Forecasting and Hazard Avoidance

InactiveUS20170178037A1Predict in advanceIncreased riskReservationsForecastingBusiness forecastingIT risk

The invention relates to an air travel scheduling platform that incorporates turbulence forecast and other safety data into search results and flight query filters such that air travelers can choose flight options that minimize their risk of experiencing turbulence, or exposure to other hazardous events. It also allows travelers to monitor turbulence and other hazardous forecasts for specified flights.

Owner:KAYE EVAN JOHN +1

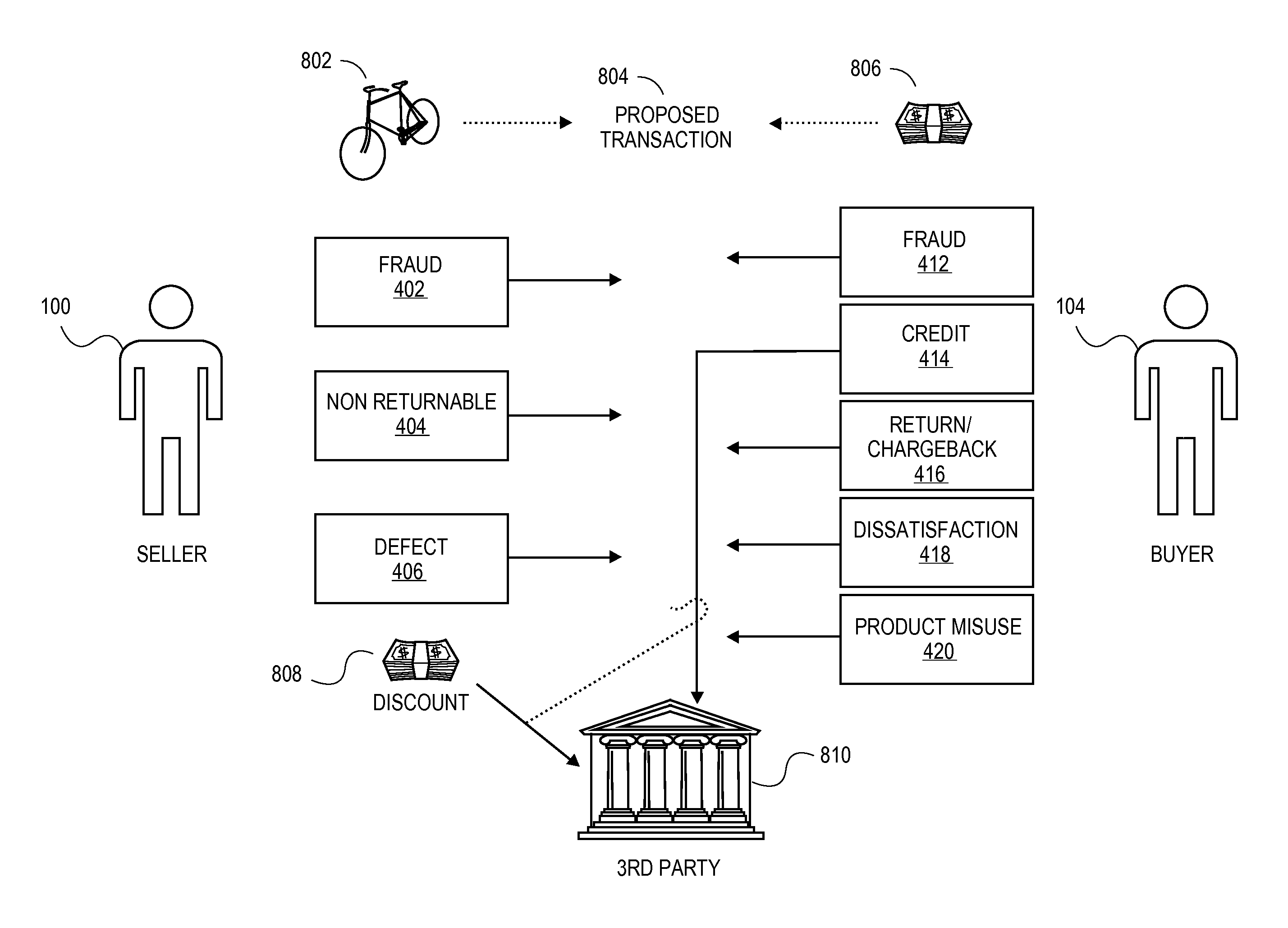

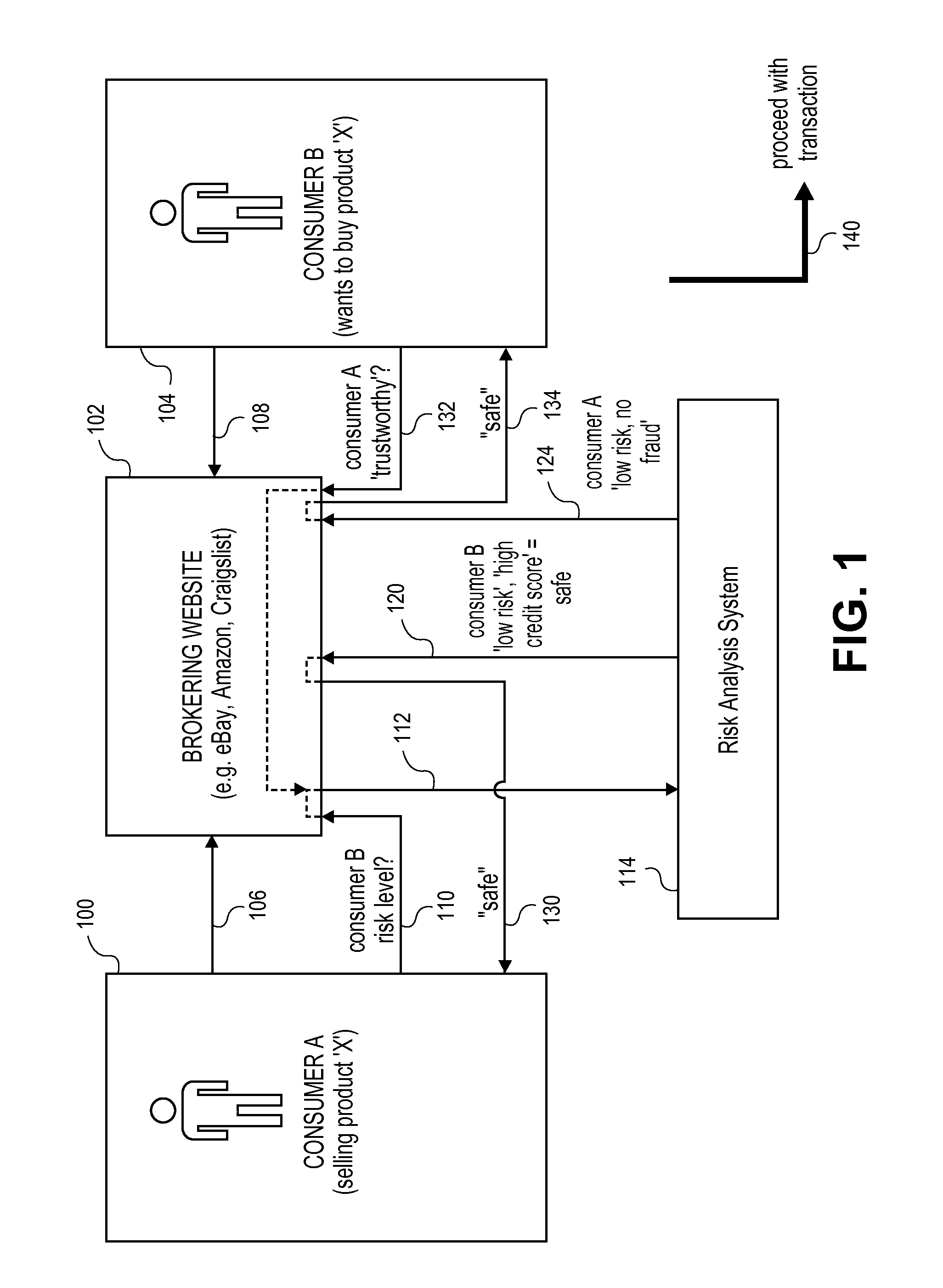

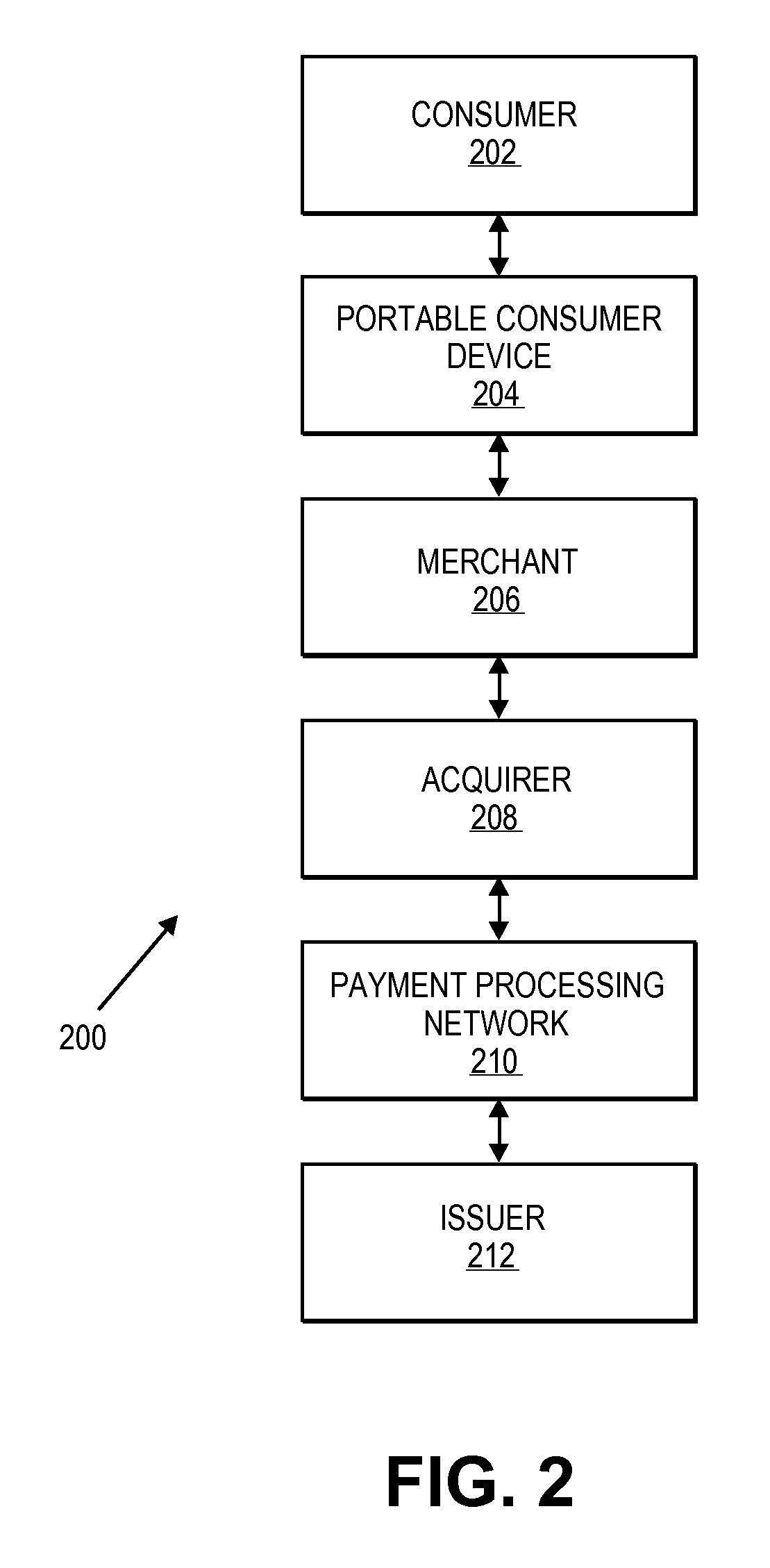

Transaction data repository for risk analysis

ActiveUS8600855B2Dispel doubtsBetter idea of the good faith of the partyFinancePayment architectureRisk levelPayment

Systems and methods are presented for determining risk levels for consumer-to-consumer (C2C) transactions on brokering websites. The risk levels can be based on payment processing network (e.g. Visa) account data as well as external data, such as geo-location using IP addresses, fraud bureau data, and star ratings. The buying and selling consumers can have multiple risk scores for each transaction, such as a fraud, credit, return / chargeback, dissatisfaction, product misuse, nonreturnable, and defect risk scores. The buying and selling consumers can trade their risk levels before proceeding with the transaction.

Owner:VISA INT SERVICE ASSOC

Risk-based reference pool capital reducing systems and methods

Embodiments consistent with the present invention provide a credit enhancement structure for risk allocation between parties that minimizes the regulatory capital reserve requirement impact to an institution subject to capital reserve requirement. A subject pool of assets held by the institution, such as a pool of loans, is rated to determine its risk levels. Based on the rated risk levels, a guarantor party agrees to be responsible for a portion of the risk associated with the pool of assets, which may define the maximum risk exposure of the institution holding the asset pool. The risk-rated capital reserve requirements are applied to the asset pool based on the risk level rating and the guarantor's agreed upon risk responsibility such that the institution holds a reduced amount of reserve capital compared to what it would otherwise be required to hold.

Owner:FREDDIE MAC

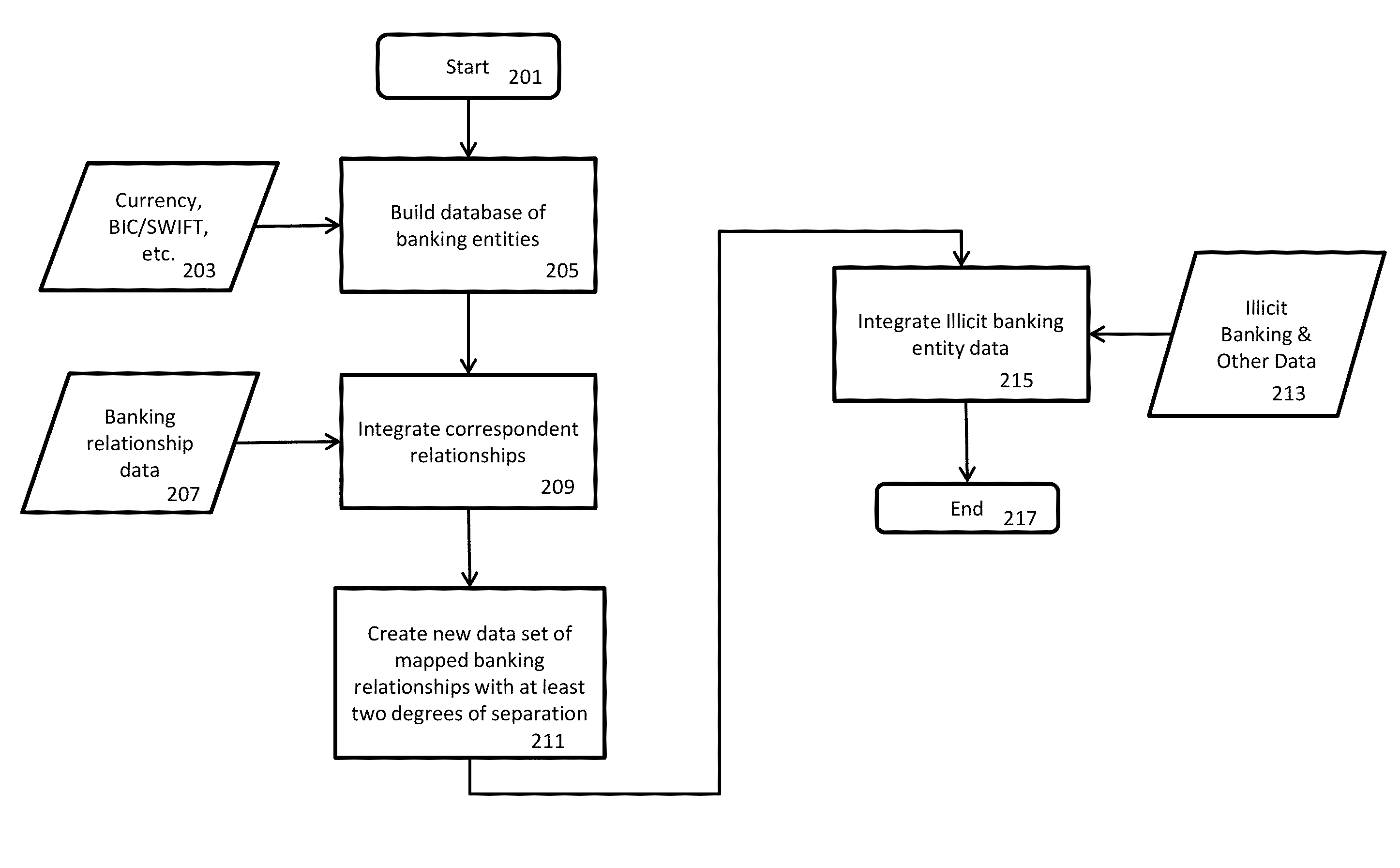

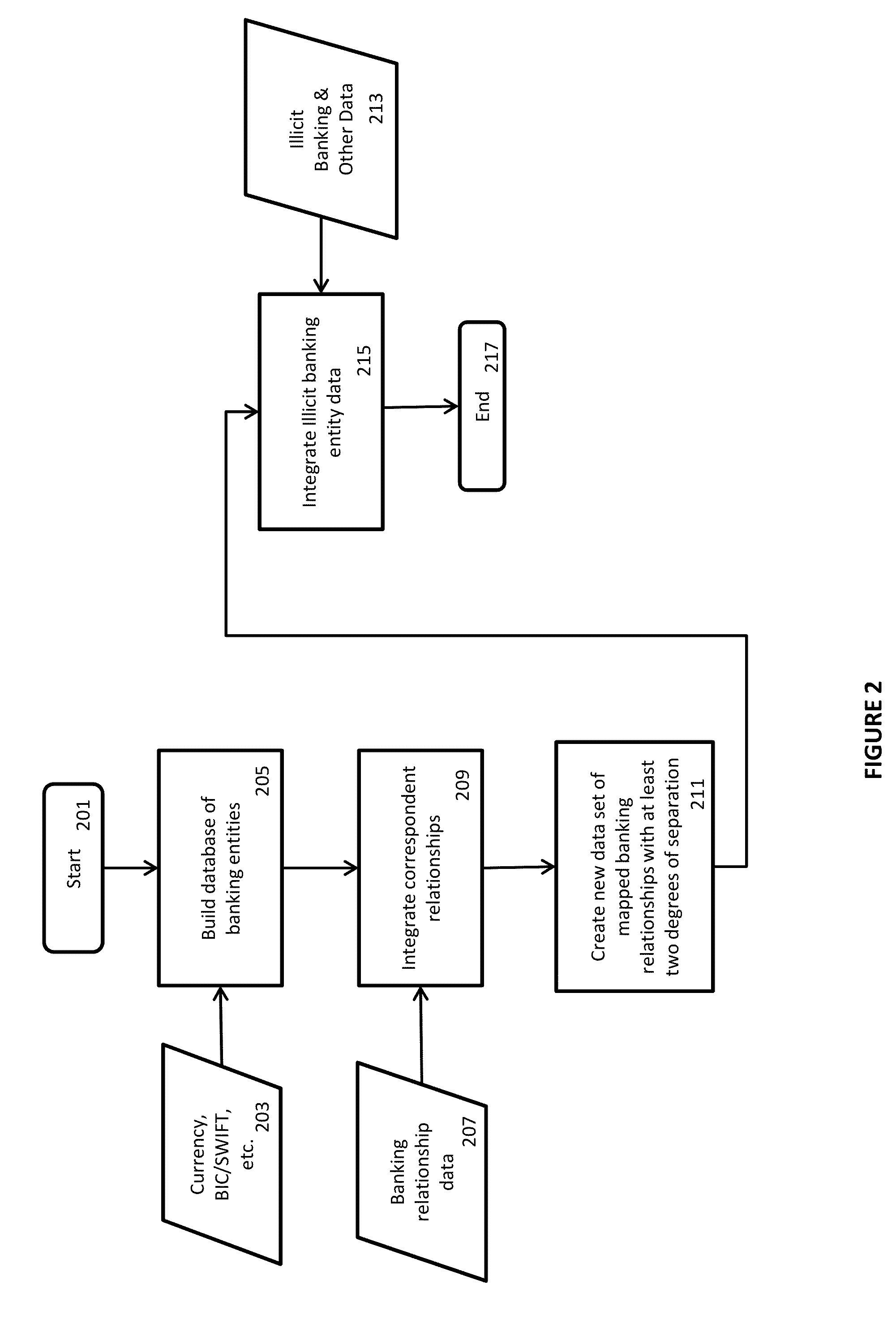

System for monitoring the compliance relationships of banking entities with validation, rerouting, and fee determination of financial transactions

A system and method for validating a given wire or financial transaction to determine if the destination bank or any connecting or correspondent banks have a direct or indirect relationship with an illicit entity and, if an illicit relationship is identified, the system attempts to reroute the transaction along a compliant path. Such indirect illicit relationship may be set to require at least two degrees of separation and may be user or bank defined depending on their risk tolerance. The rerouted compliance path may identify multiple paths and rank and prioritize that paths based on risk tolerance, associated fees of the banking touch points, and can automatically approve reroutes or display paths to the user for selection. Further, the system allows banks to set and can then determine any compliance fee splits amongst all entities that may receive a portion of the fee and any adjustments from any rerouted paths.

Owner:JORISCH AVI +1

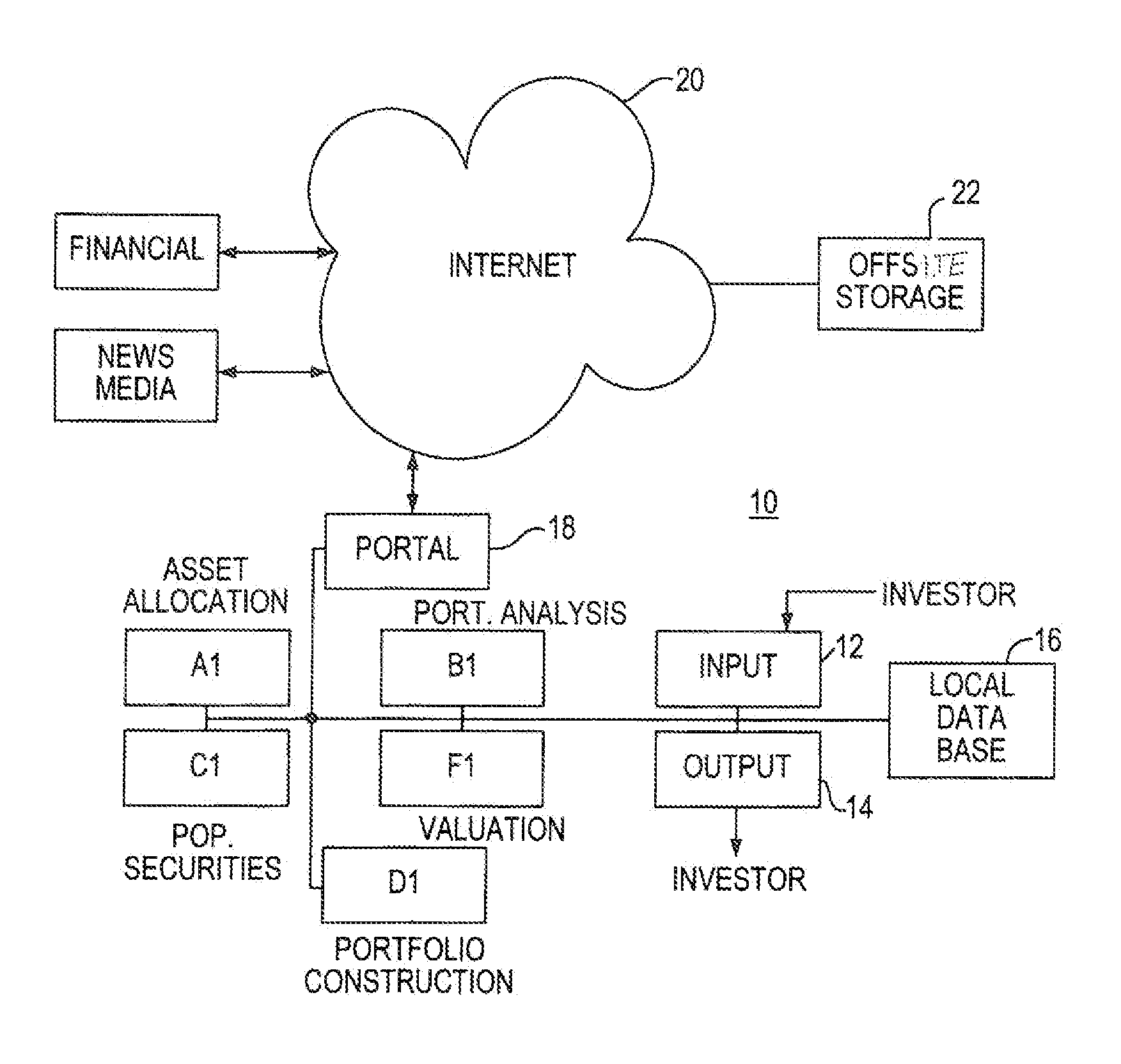

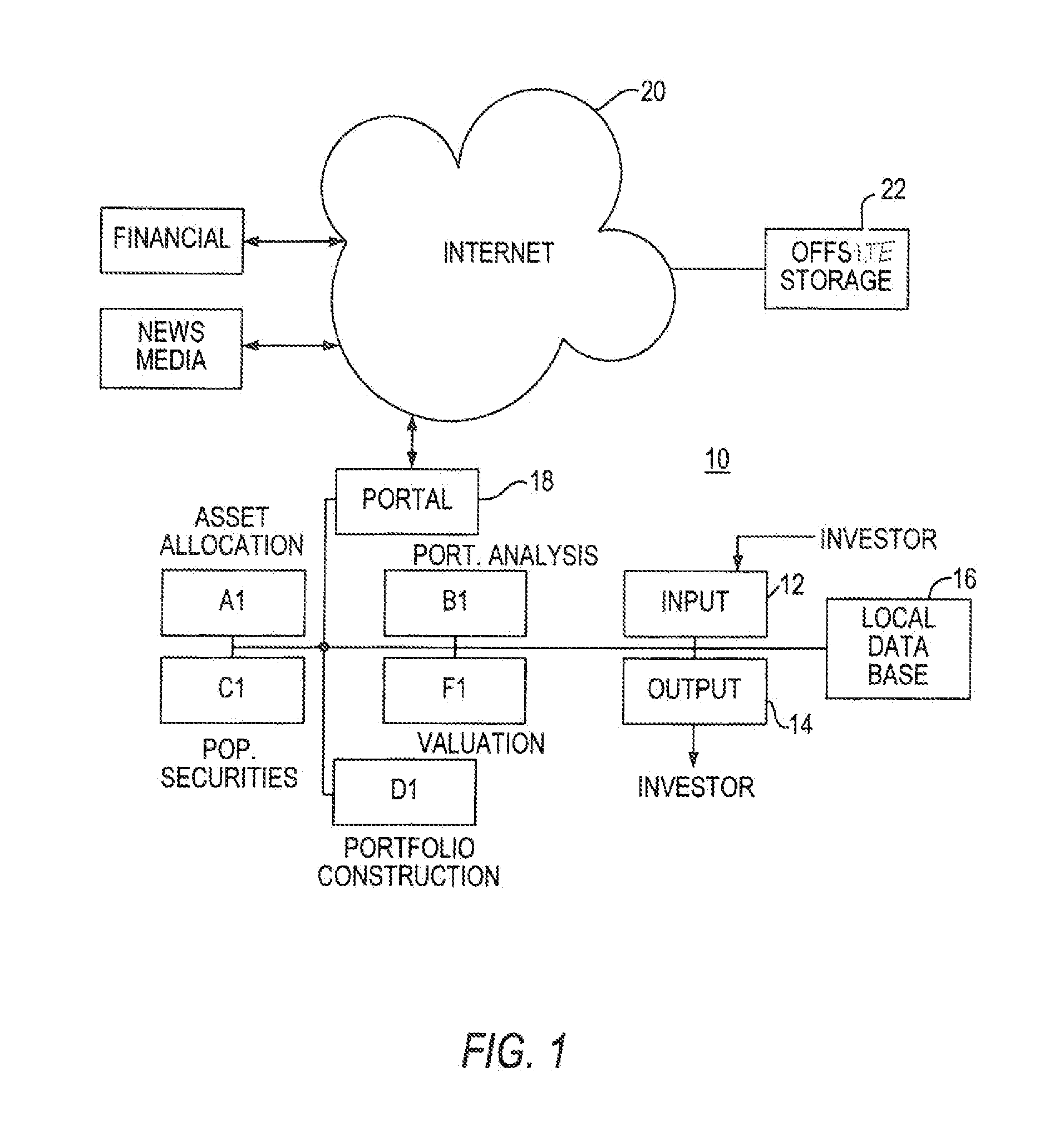

Method and apparatus for investment strategies derived from various research methodologies and extractions

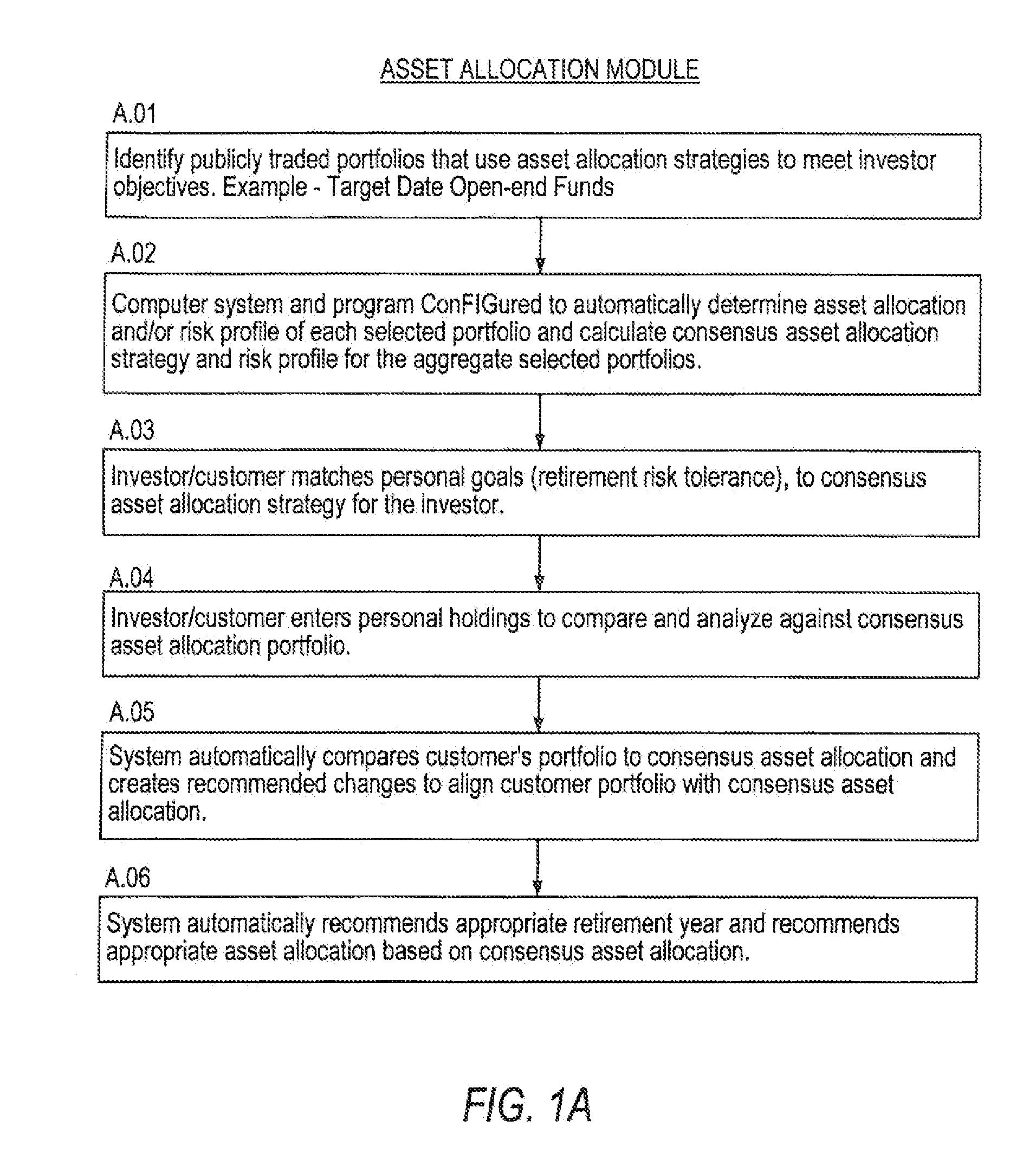

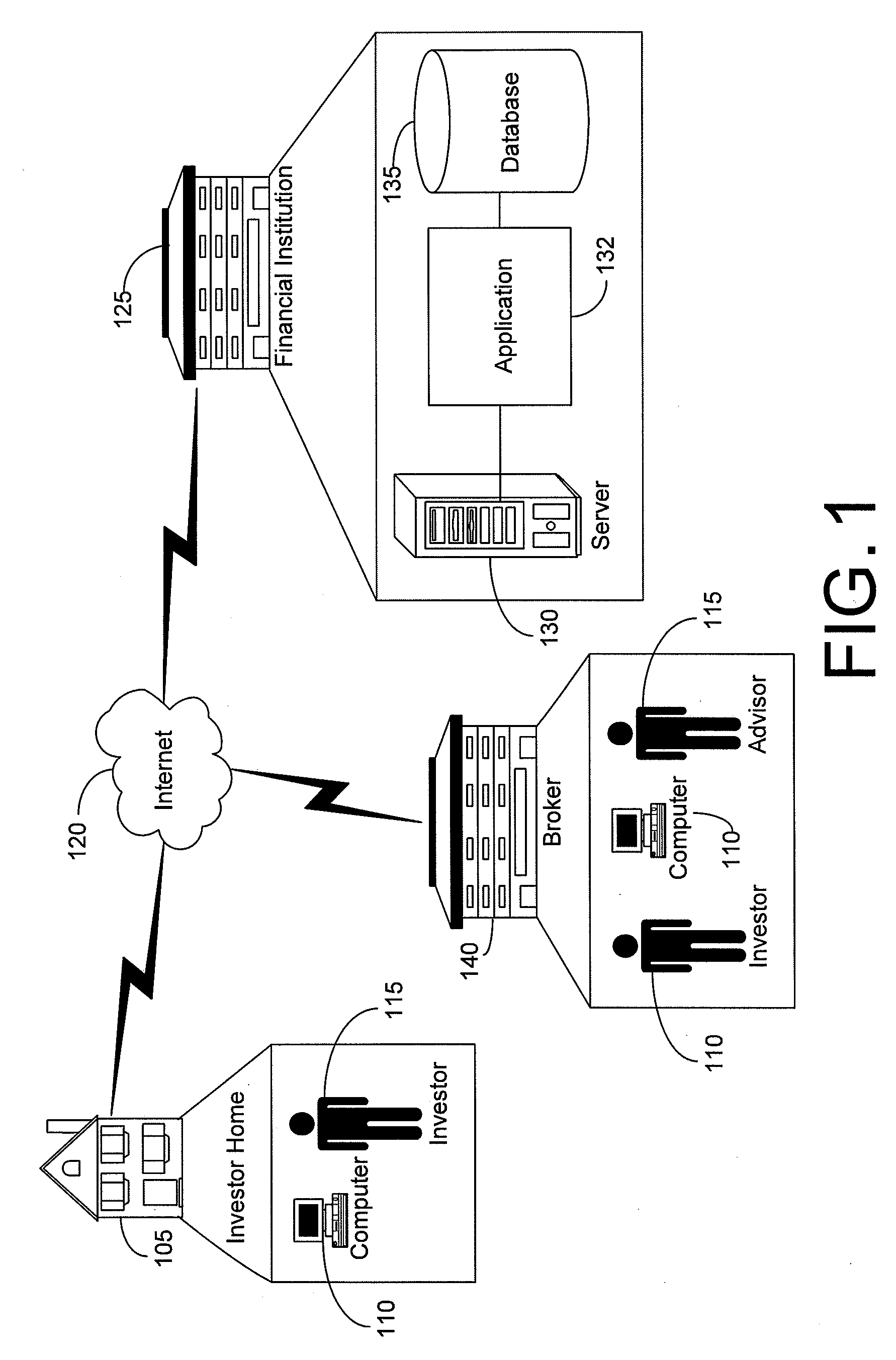

The present invention provides a computer based apparatus and methodology for generating investment strategies for individuals by using a variety of research and screening methodologies to extract investment tools and data from publicly available data basis, while also utilizing computerized search skills, this business model looks to improve on investment methods currently offered by brokers and registered investment advisors. Several modules are provided that perform certain analyses based on information from the investor as well as other sources. Each module can be used as a stand-alone unit or can share information and prepare aggregate reports to the investor. In one preferred embodiment, an asset allocation module is used to generate a proposed asset allocation to an individual based on at least one of his risk profile, assets, and planned retirement age.

Owner:SARKANY MICHELLE +1

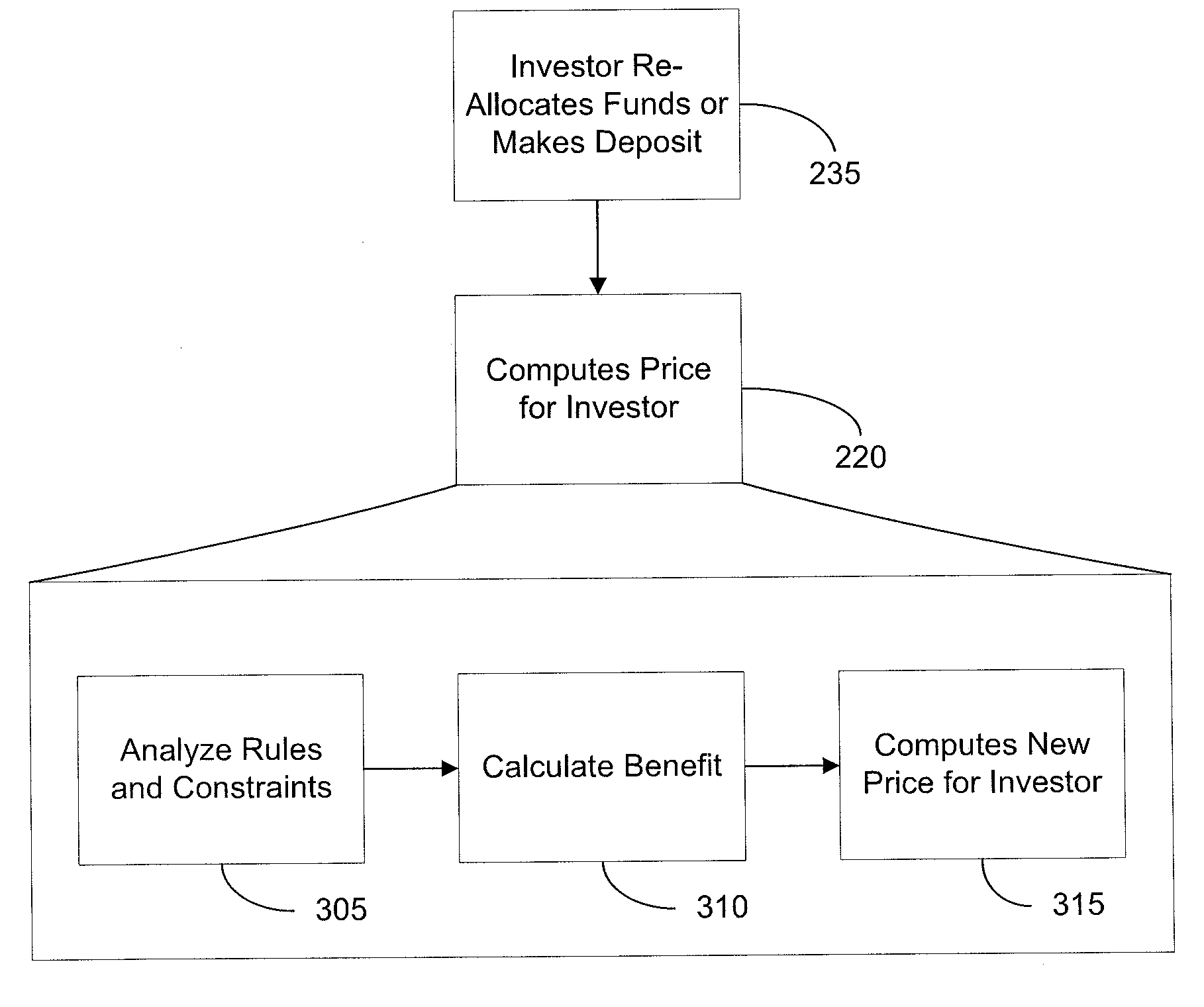

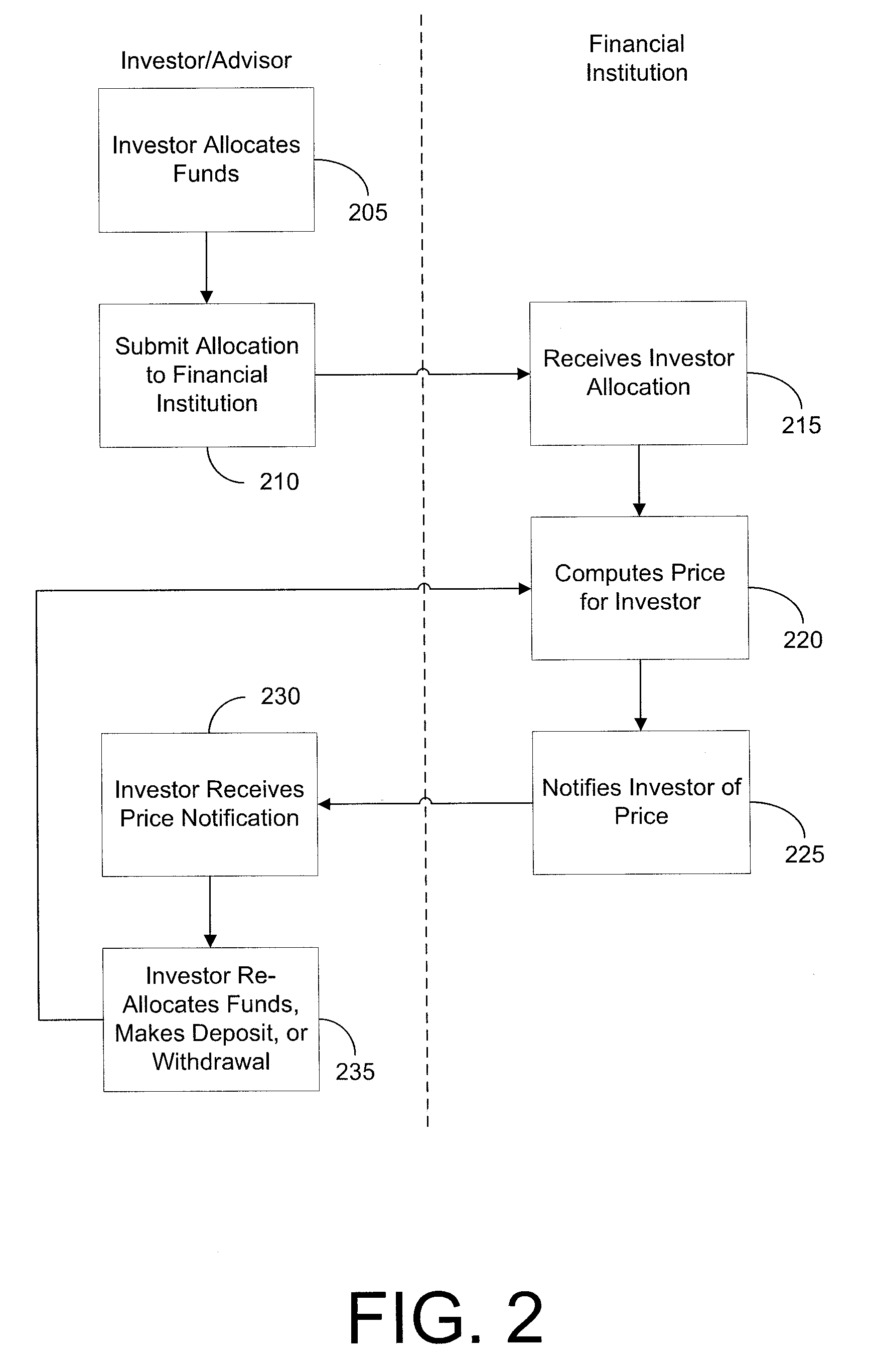

Behavior based pricing for investment guarantee insurance

Aspects of the present disclosure allow an insurance company or other institution to manage its risk by establishing a charge consistent with hedging costs in offering a minimum guarantee on an underlying investment product to its customers. Such guarantees on underlying investment products may be included in, but are not limited to, variable annuities and contingent deferred annuities (CDA). Embodiments of a process are disclosed by which the charge for a guaranteed benefit in an investment product on underlying investments can vary by investor based on actual investment behavior. Advantageously, the insurance company or other institution can better manage its risk by reducing exposure from the actual experience compared to the investment behavior assumption and enable benefits to be charged more precisely for the actual risk taken (e.g., the insurance company can offer lower cost benefits for customers who are more risk averse).

Owner:AMERICAL INTERNATIONAL GROUP INC

Self-sufficient resource-pooling system for risk sharing of airspace risks related to natural disaster events

Owner:SWISS REINSURANCE CO LTD

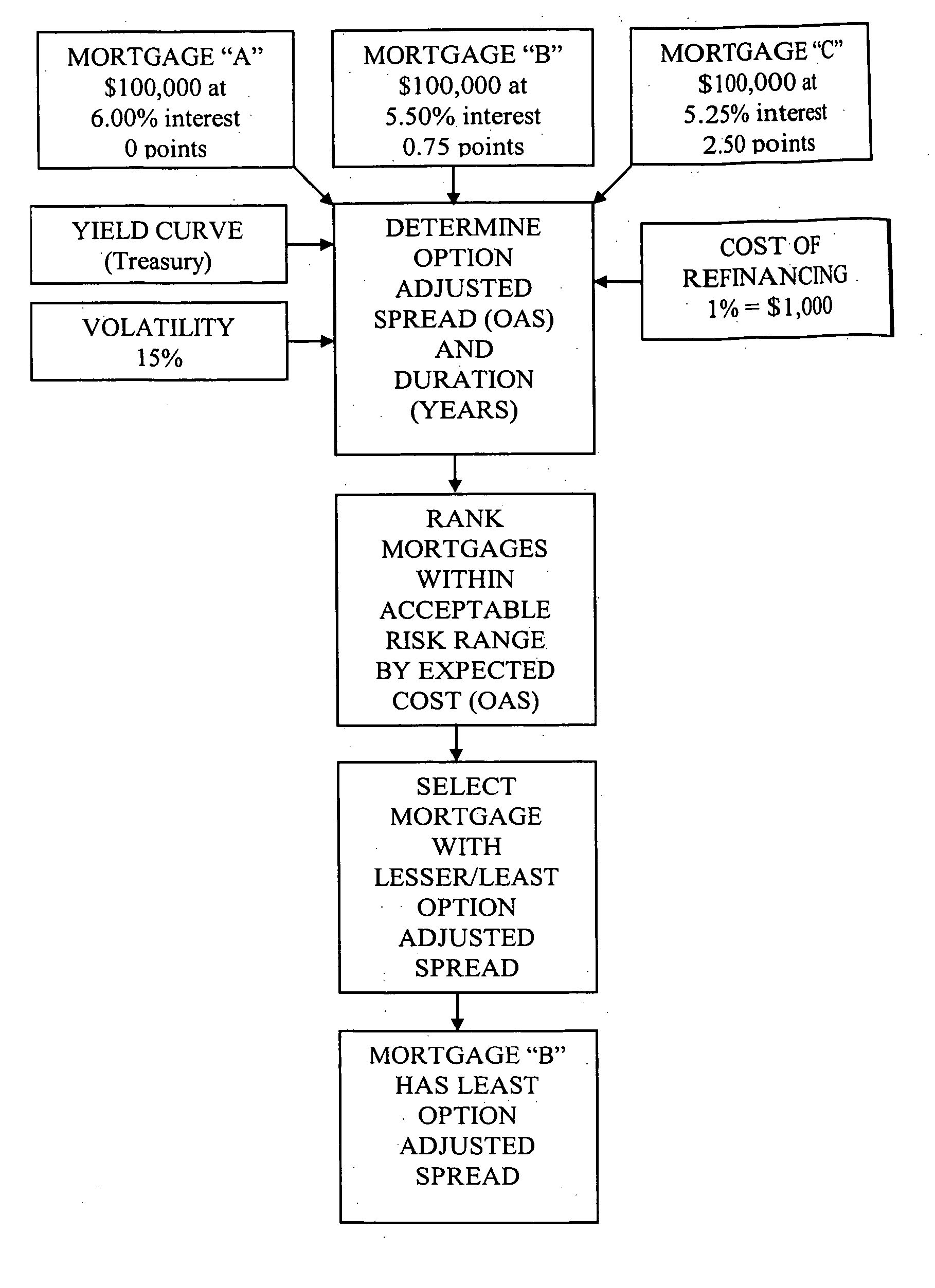

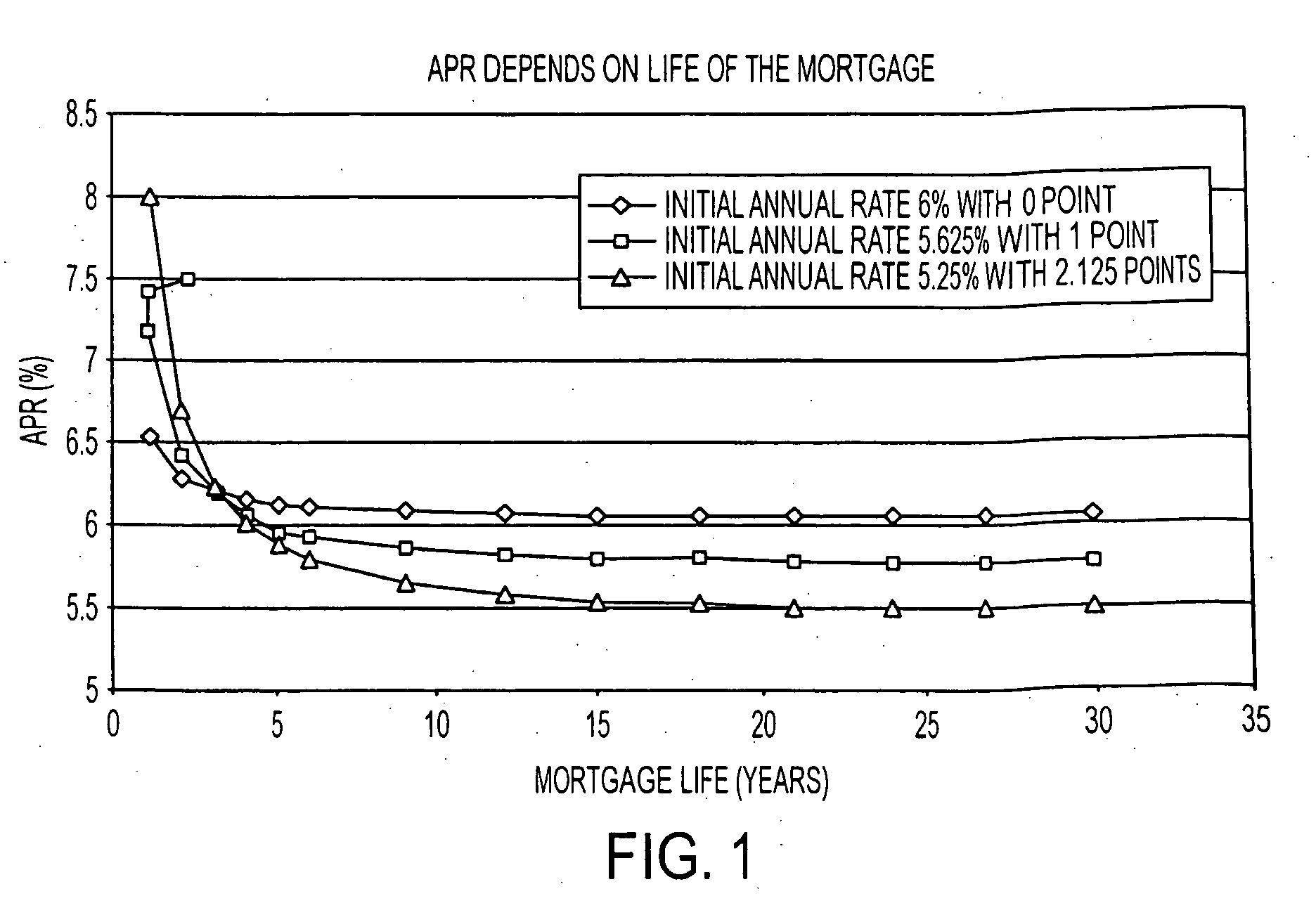

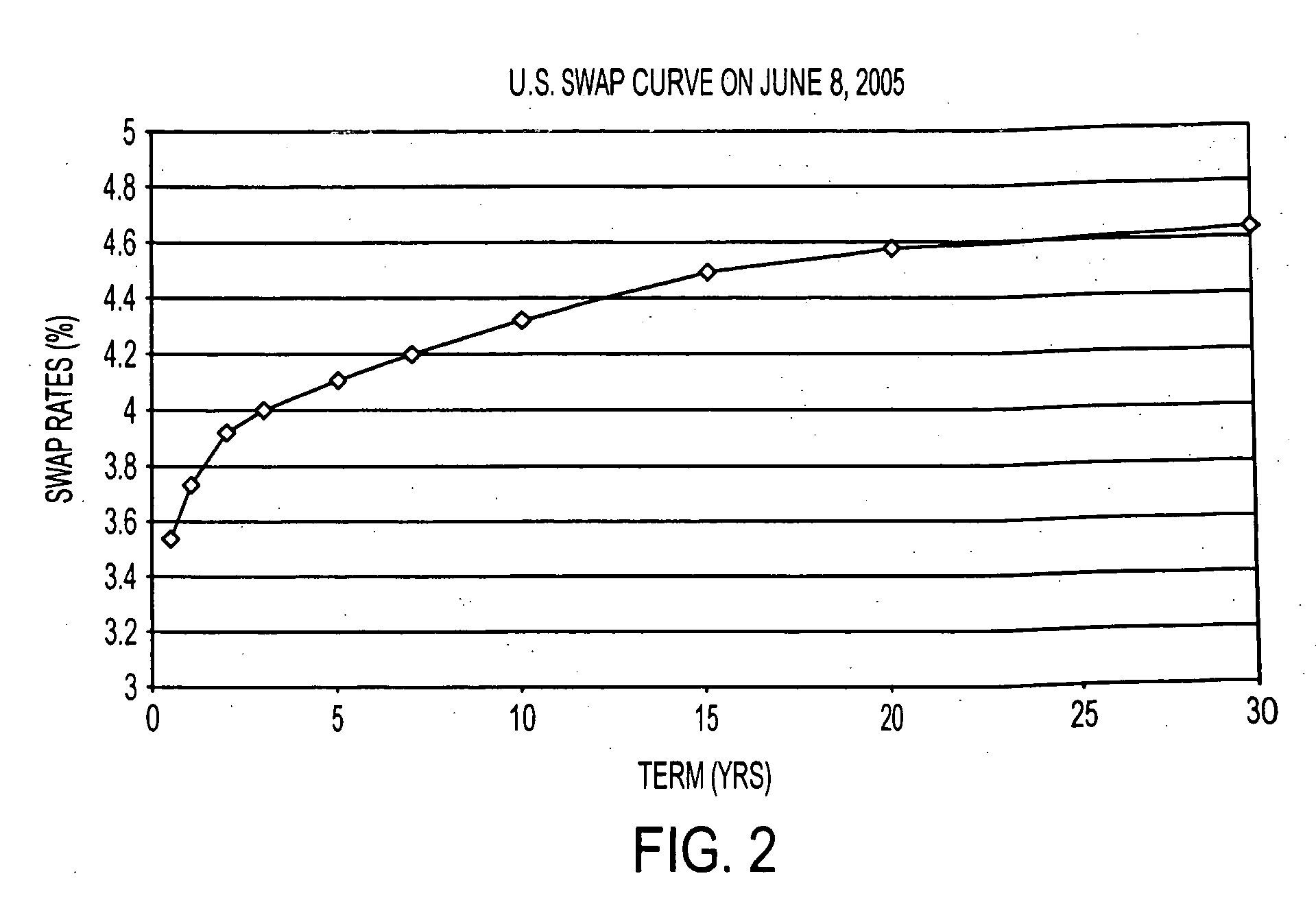

Method and system for determining which mortgage choice is best for a consumer

A method and system for selecting a preferred debt instrument (e.g., mortgage) for an individual consumer, where the option adjusted spreads (OAS) and risk measures of a plurality of debt instruments are determined and ranked using standard bond valuation methodology. A typical scenario involves a consumer inputting a plurality of mortgages and associated features (e.g., term of loan or type of interest rate) and receiving the option adjusted spread and risk measure for each mortgage, from which the consumer may select the appropriate mortgage having the lowest option adjusted spread within his or her risk tolerance. These steps can be implemented by a computer which includes a central processing unit (CPU) and a computer code operatively associated with the CPU. The relative option adjusted spreads and risk measures of various debt instruments can be displayed on a visual display or used to automatically commence the financing of a mortgage.

Owner:ICE DATA SERVICES INC

System for Managing Risk in Employee Travel

ActiveUS20130162529A1Cathode-ray tube indicatorsInput/output processes for data processingRisk levelRisk map

A system for managing risk in employee travel may display a world risk map having countries color coded or otherwise indicating a risk level associated with each of the countries. The countries may be assigned to geographic groupings, such as continents, and the countries of the geographic grouping may change to a uniform color or other indication when the cursor is disposed within the boundaries of one of the countries of the geographic grouping. Clicking on the geographic grouping may cause the world risk map may cause the display to zoom in on an enlarged geographic group map with the countries displayed with their risk level indication. Clicking on one of the countries may cause a country information page to be displayed.

Owner:WORLDAWARE INC

Risk Assessment Company

A Risk Assessment Company (RAC) maintains an up to date Risk Profile Data Base (RPDB) on its members based on their normal periodic updates to the RPDB. The Risk Assessment Company, therefore, can provide risk assessment results which can be utilized by a plurality of insurance carriers to determine an appropriate underwriting class for individual user subscribers who apply for insurance. The Risk Assessment Company can also provide a member with a risk assessment result report containing suggestions on how said person can better manage his or her risk exposure.

Owner:BAKOS THOMAS L

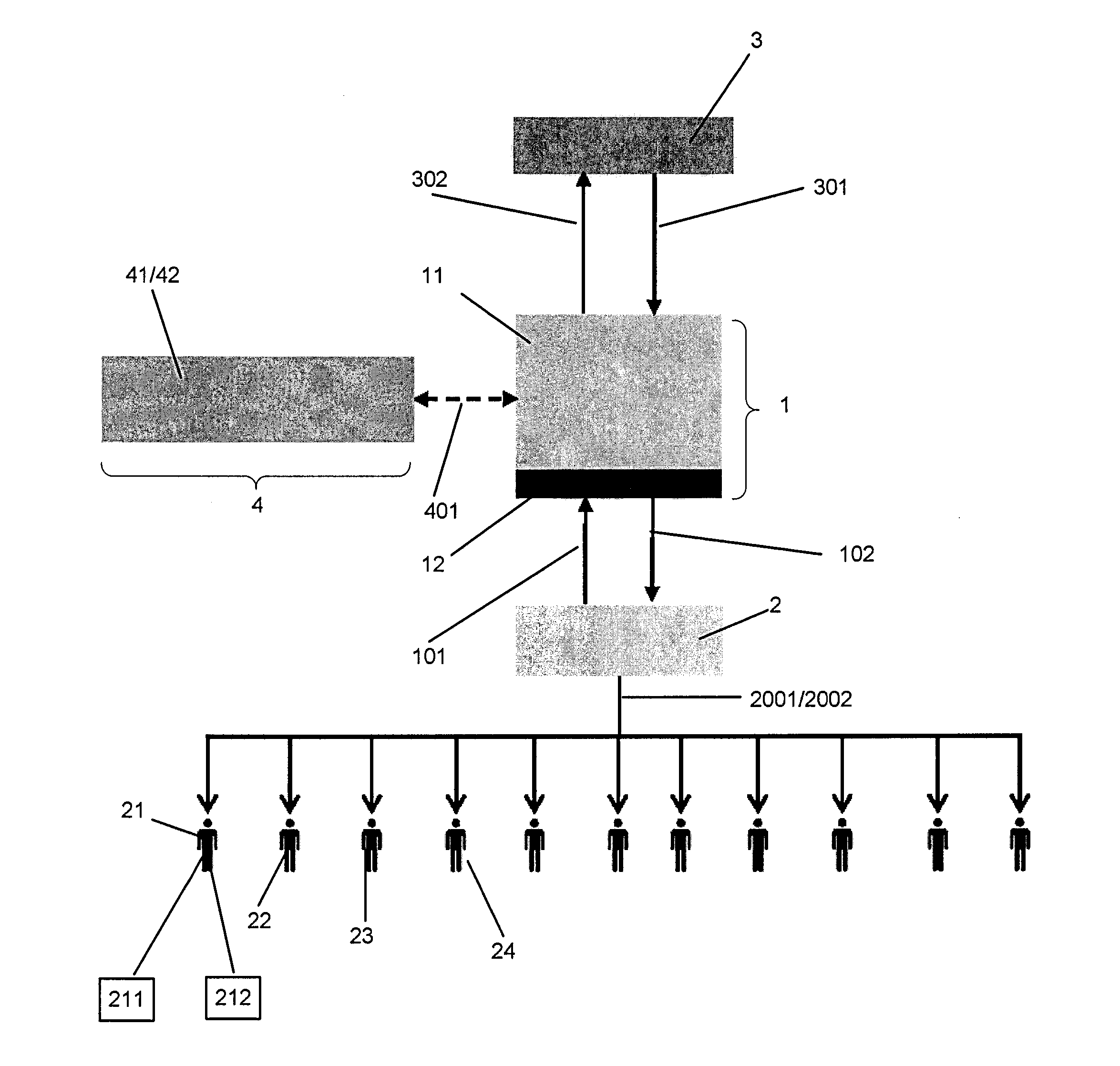

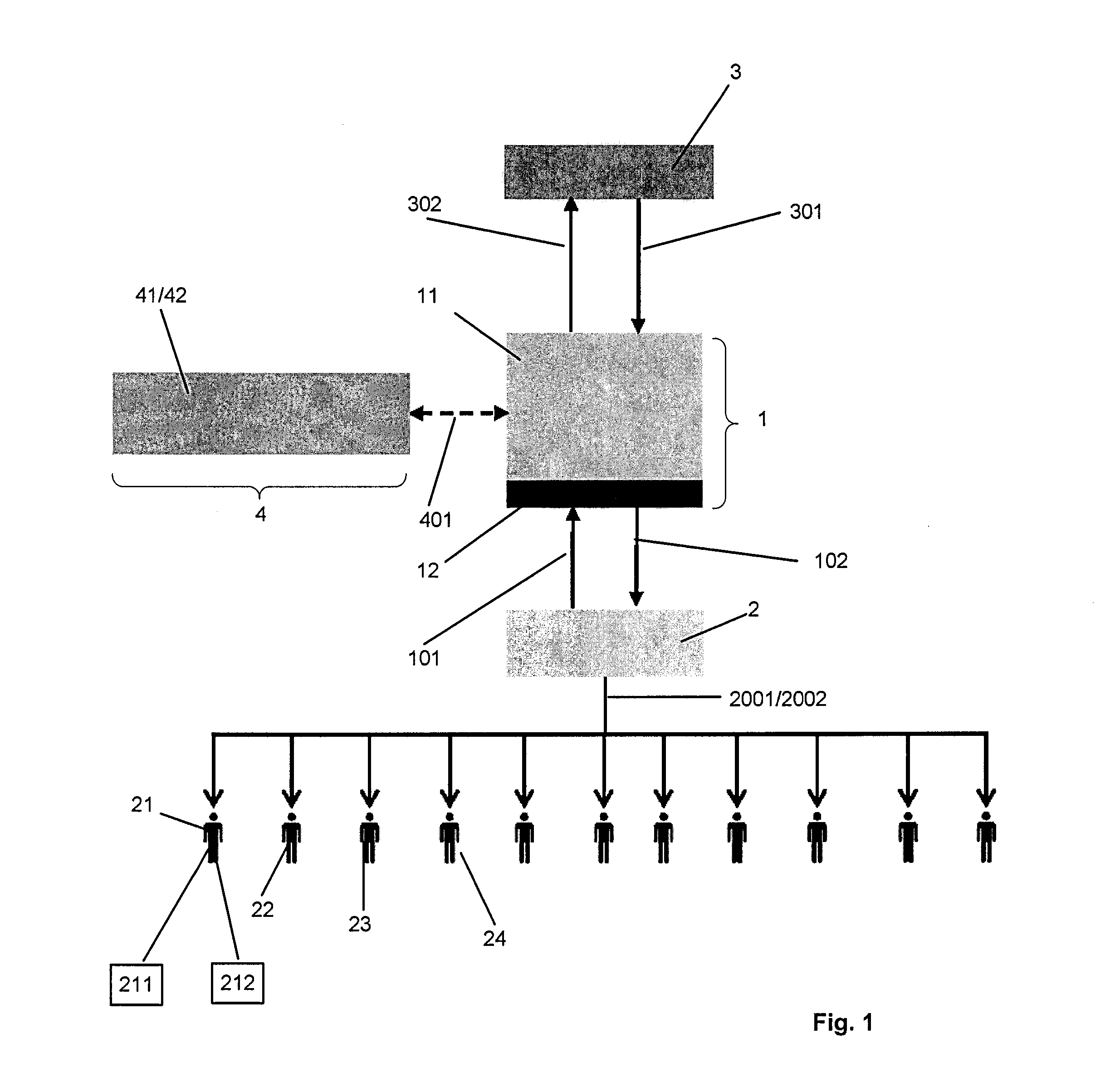

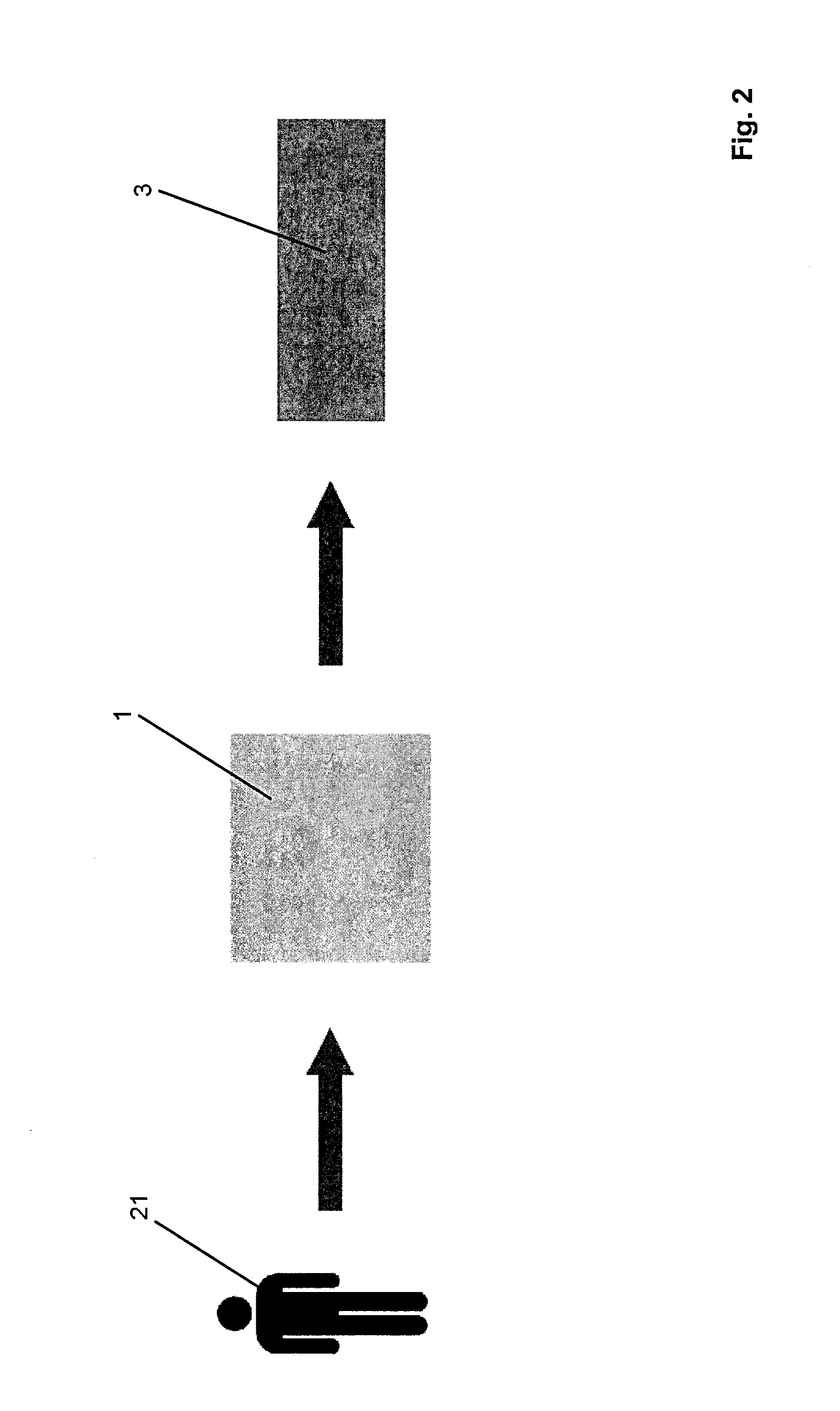

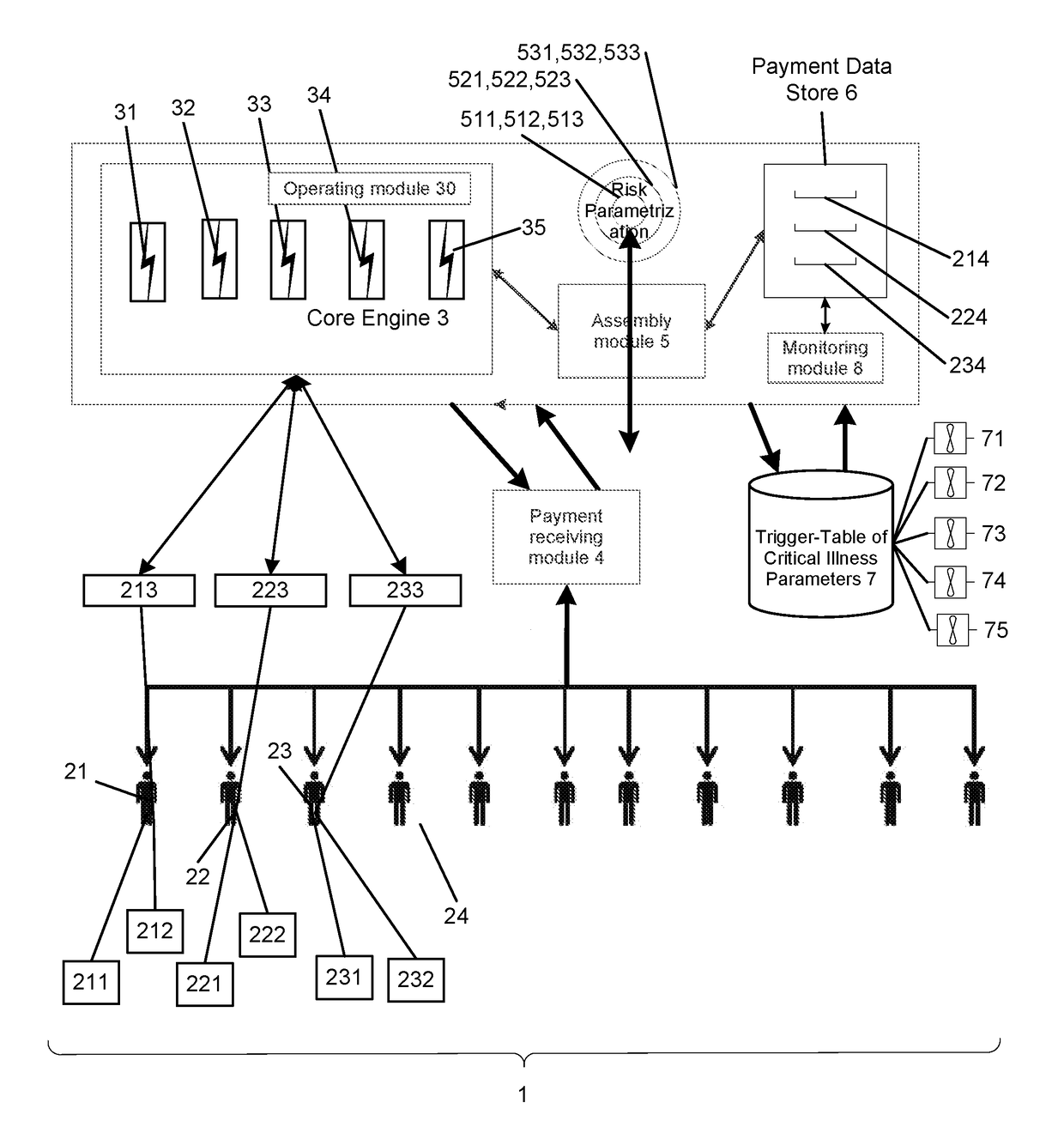

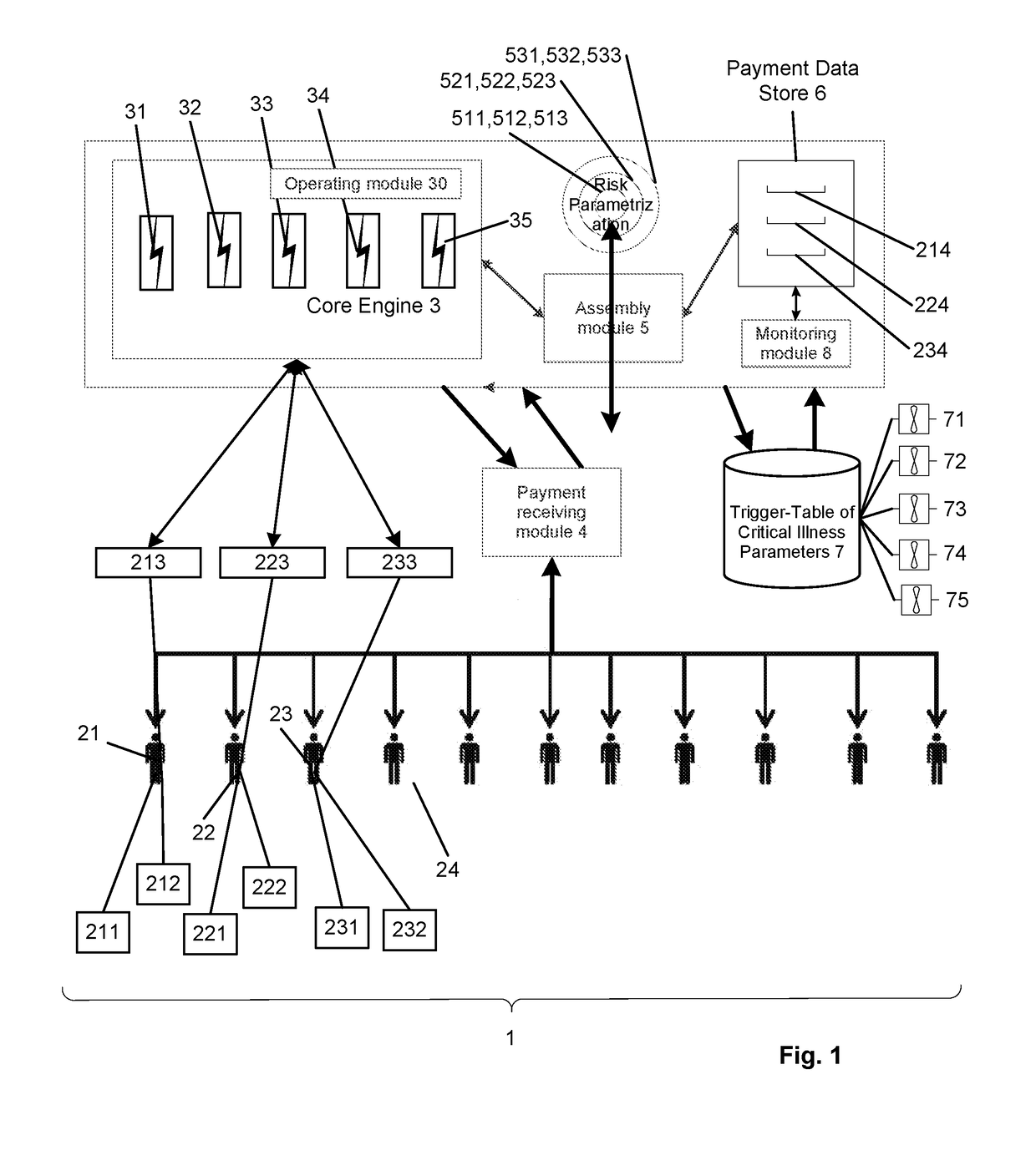

Micro-resource-pooling system and corresponding method thereof

The invention relates to a resource-pooling system and to a corresponding method for risk sharing of a variable number of risk exposure components. The risk exposure components are connected to the resource-pooling system by means of a plurality of payment receiving modules configured to receive and store payments from risk exposure components for the pooling of their risks. The total risk of the pooled risk exposure components comprises a first risk contribution associated to risk exposure in relation to loan losses, and a second risk contribution associated to risk exposure based on emergency expenses. The pooled risk is divided in a parameterizable risk part and a non-parameterizable risk part by means of an indexing module. In case of triggering a loss by means of a trigger module, the suffered loss is covered by releasing associated loans and emergency expenses of the risk exposure components.

Owner:SWISS REINSURANCE CO LTD

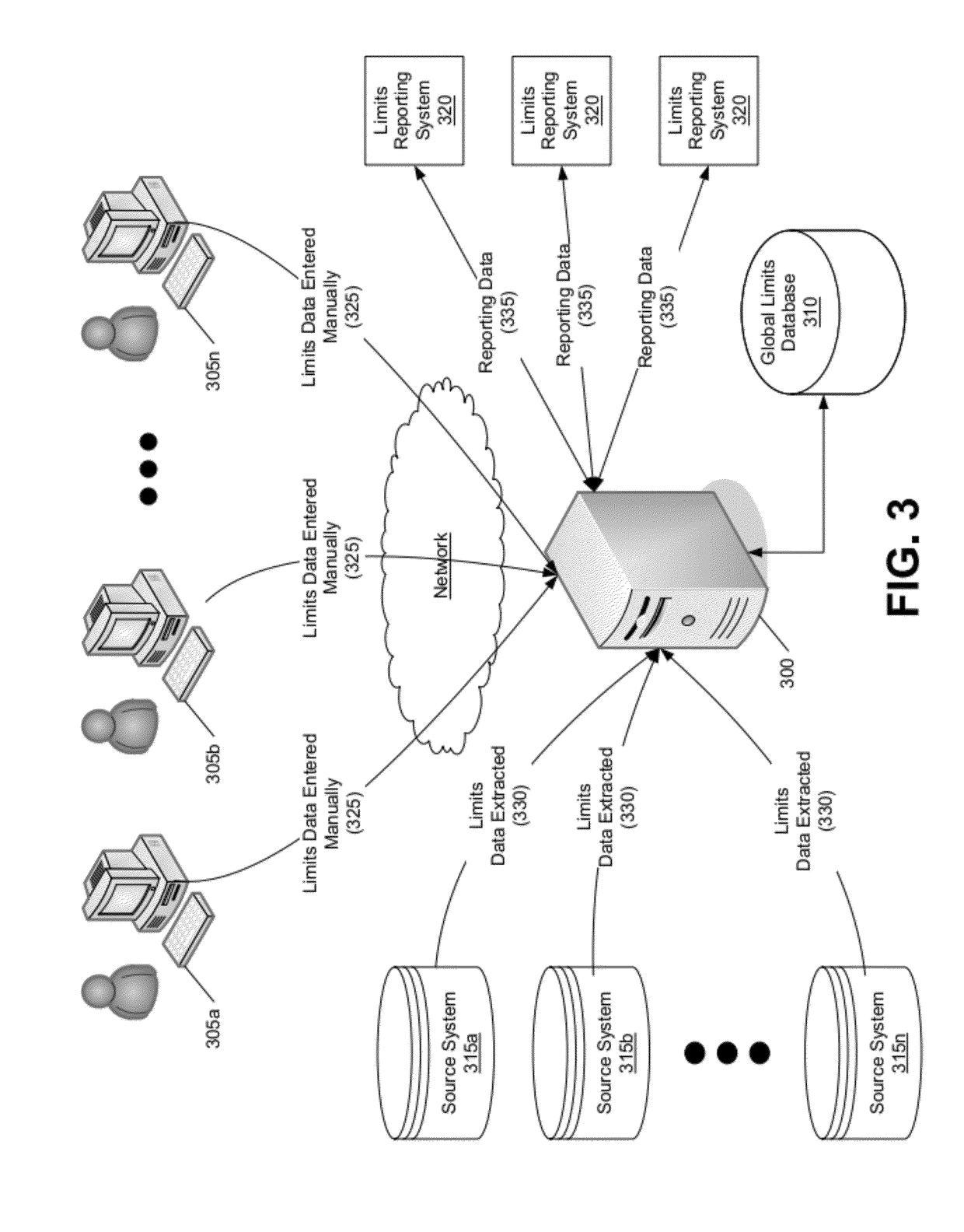

Global Treasury Monitoring System

A global treasury monitoring system can provide a single centralized system of record for maintaining and updating global treasury limits to enable an organization to consistently allocate, apply and manage such limits across multiple types of platforms. Through a single system of record for the management of global treasury limits, an organization may comprehensively assess its risk exposure at any given time and make adjustments to limits on a real-time basis in response to rapidly-changing market conditions. The global treasury monitoring system can provide an organization with the ability to access, evaluate and reconfigure recorded treasury limits in real-time through various graphical user-interfaces (GUIs) accessible to users at various global locations. As treasury limits are utilized the system may update the availability of such limits so that an organization's risk exposure may be constantly monitored and assessed. The system also provides an organization with additional flexibility in programming a client's treasury limits to match the client's various liquidity needs around the globe while also managing the amount of the risk that the organization is willing to take on to attain appropriate returns.

Owner:BANK OF AMERICA CORP

Active Device for Providing Real Time Parolee Information

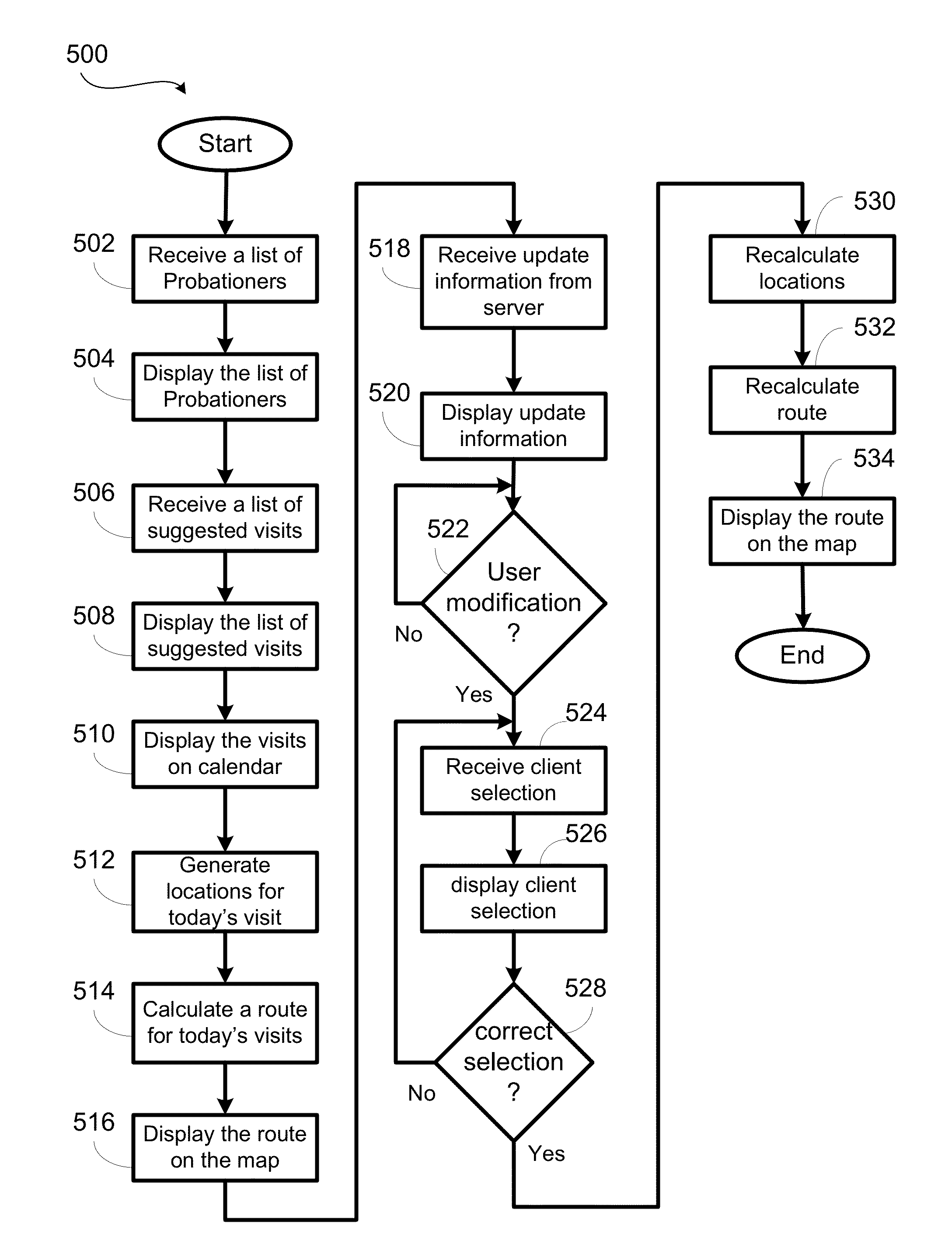

An apparatus and method that enable a case officer to manage visits to probationers according to their risk level priority. The apparatus receives probationer information from a remote supervision server and displays the information by their risk levels. The case officer can drag and drop the name of probationers on an appointment calendar which will calculate an appointment schedule according to the location of each visit, the travel time between the visits, the default first visit time, and default last visit time. After the appointment schedule is calculated, the map will display the optimized route. The case officer can manually change the order of the visits and the apparatus will automatically recalculate the appointment schedule and the route. The invention can further process all the data used to calculate risk of recidivism to predict criminal activity in a given area using location specific information and data collected for probationer management.

Owner:GOLD POST TECH

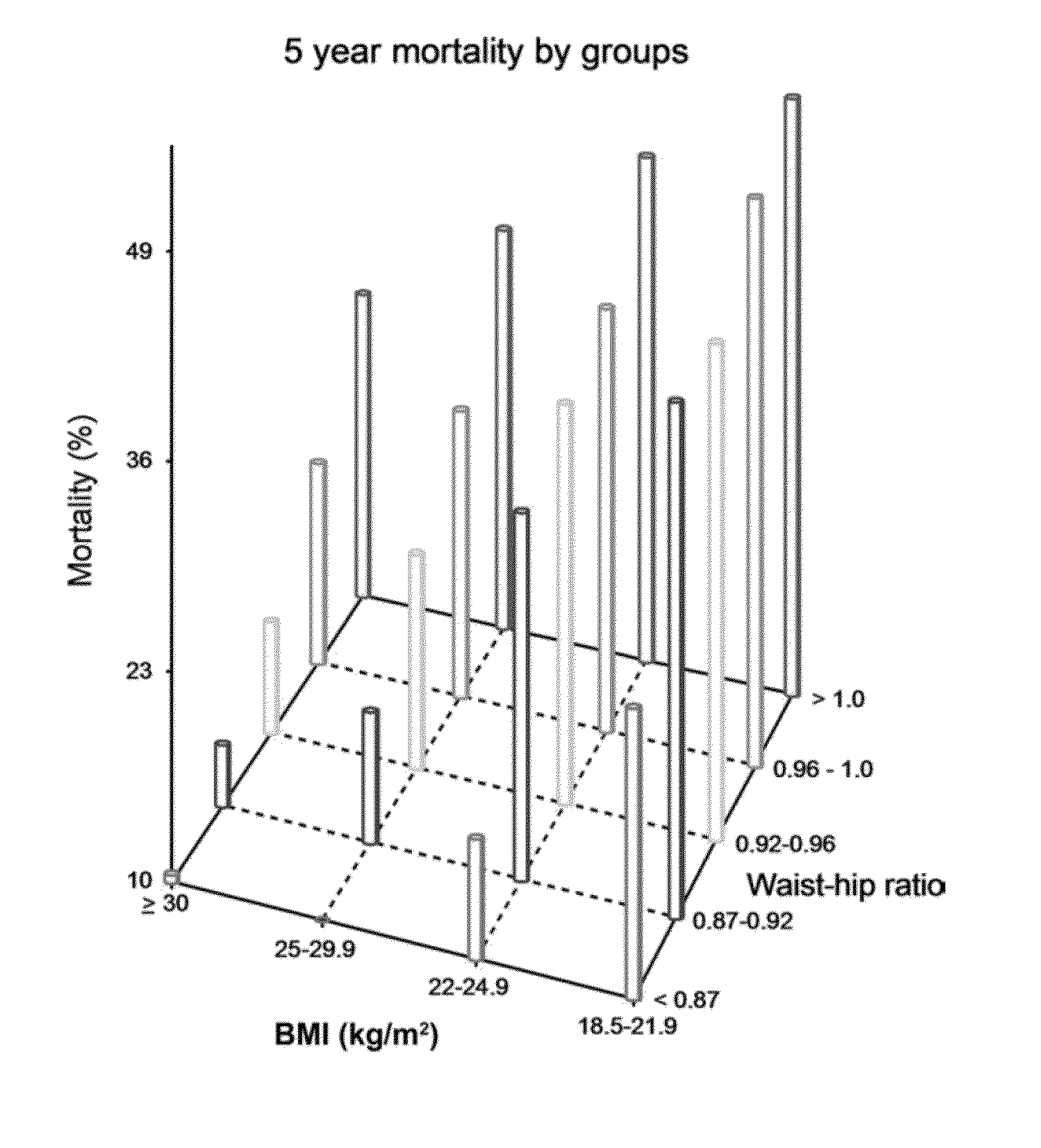

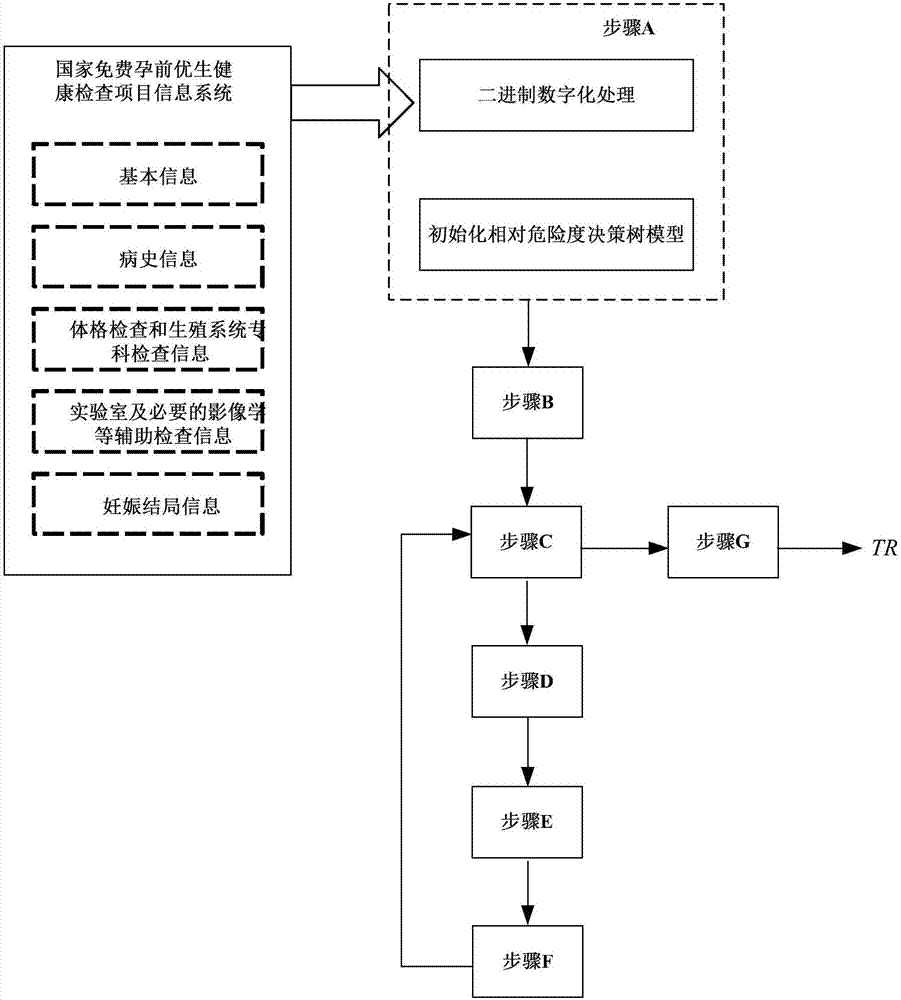

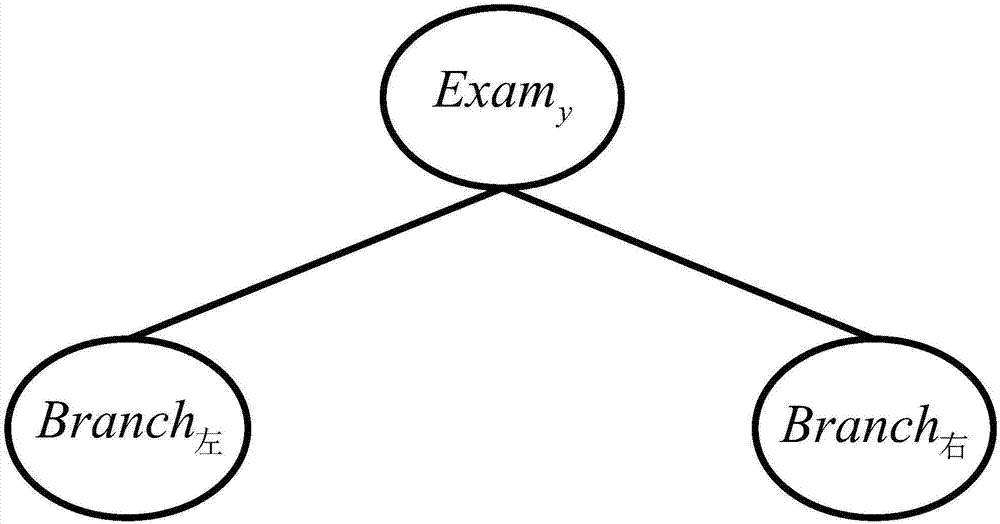

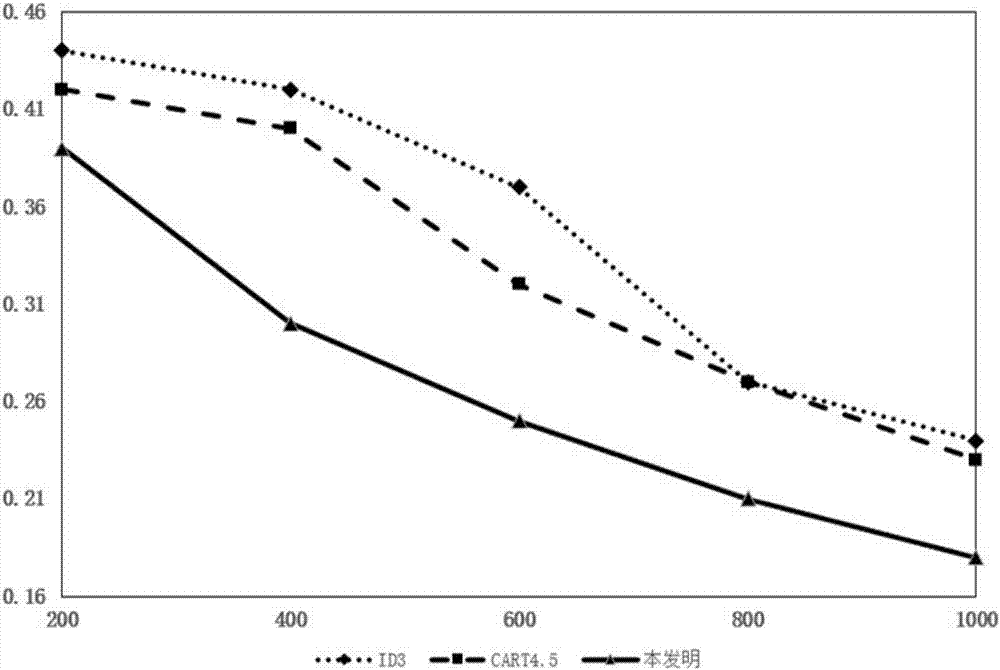

Pregnancy outcome influence factor assessment method based on relative risk decision-making tree model

ActiveCN107491656AImprove performanceImprove assessment accuracySpecial data processing applicationsNODALRelationship - Father

The invention discloses a pregnancy outcome influence factor assessment method based on a relative risk decision-making tree model. The method comprises the steps that binary digital processing is conducted on data in a national free pre-pregnant eugenic health examination item information system, then a Pg exposure value of a pre-pregnant eugenic health examination-reproductive age population exposure value multi-dimensional input matrix is obtained through establishment, and a relative risk vector RR suitable for space-time multi-dimensional condition is established according to the Pg exposure value; a pre-pregnant eugenic health examination item Examy corresponding to the maximum relative risk in the RR is selected and serves as an empty father node of the relative risk decision-making tree model TR; blade node risk factor risk serves as an empty blade node of the relative risk decision-making tree model TR. The method is applied to pregnancy outcome influence factor assessment, the assessment accuracy of pregnancy outcome influence factors and their risk factors are effectively improved, the utilization value of pre-pregnant eugenic health examination data to smart city building is improved, and the method has the important significance on promotion of social harmonious and sustainable development.

Owner:BEIHANG UNIV +1

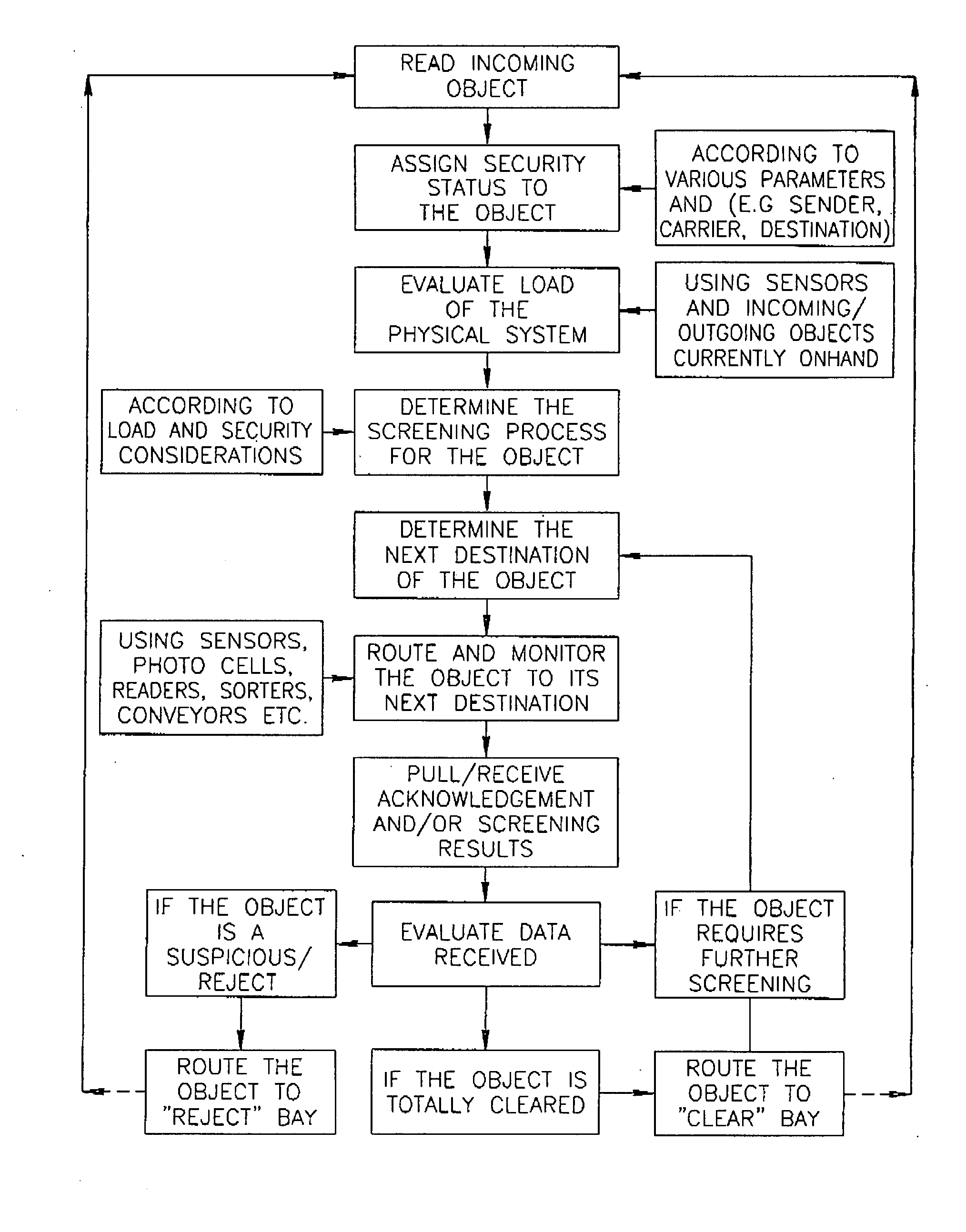

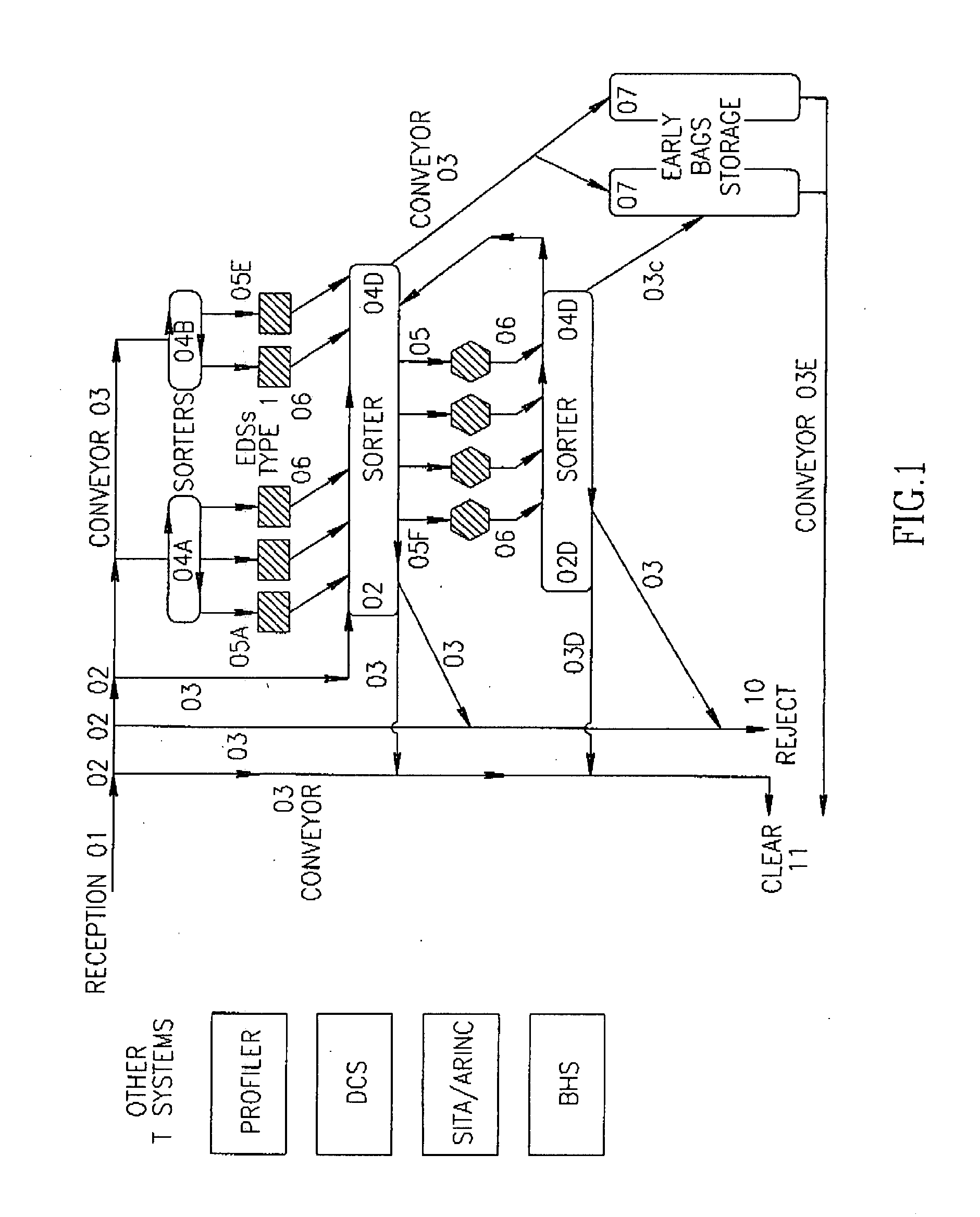

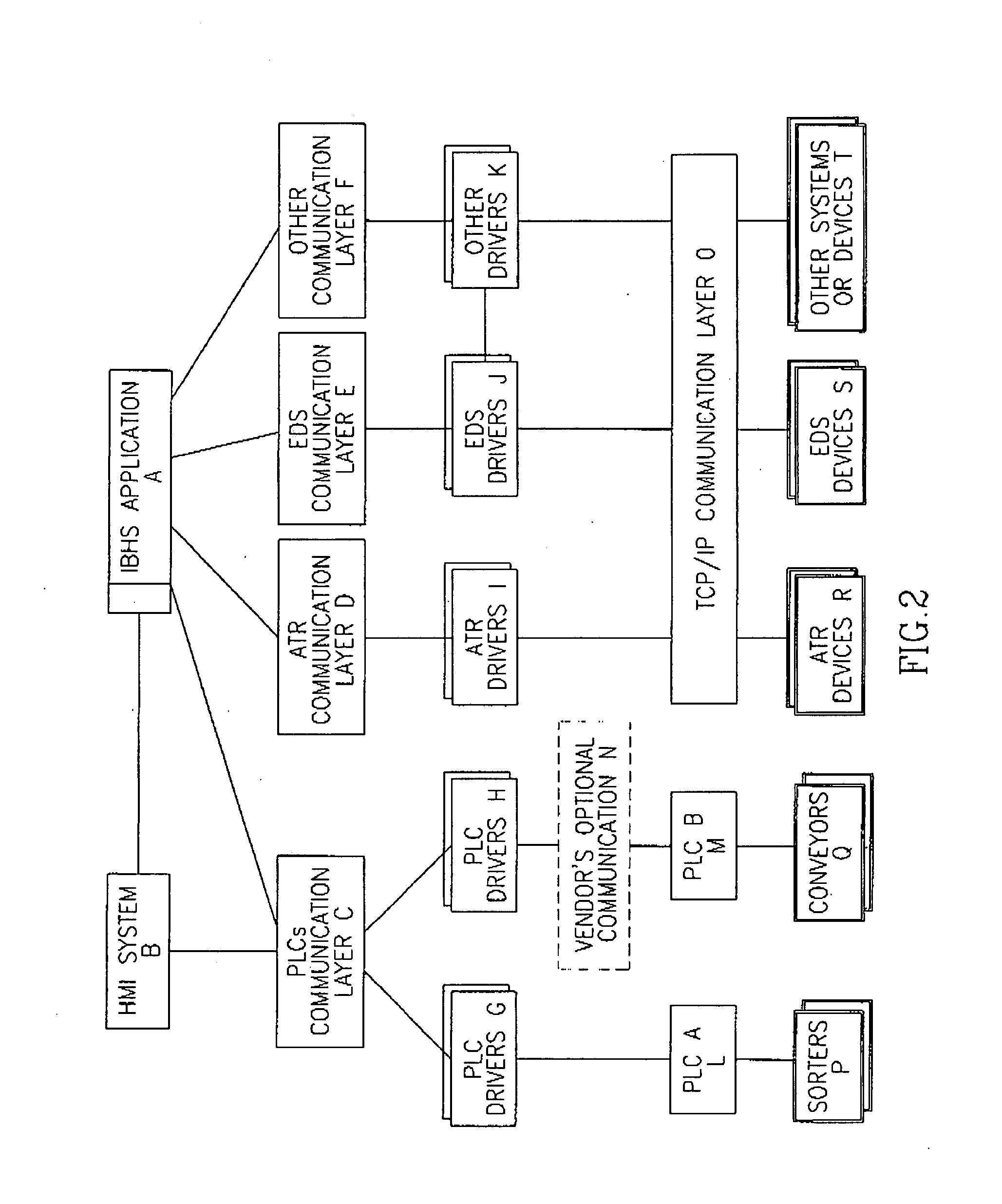

Screening system for objects in transit

InactiveUS20080156704A1Improve the detection rateEliminate disadvantagesFreight handling installationsSortingControl systemBorder crossing

The present invention relates to the screening of objects in-transit and materials, for security purposes (i.e. explosives detection).The invention provides an adjustable computerized system suitable for use at airports, seaports, land terminals, distribution centers, railway terminals, border crossings or other transit terminals, in order to achieve maximal efficiency and detection reliability, by adjustment of the screening process of any specific object to its risk factor in conjunction with the characteristics of the available in-line detection equipment.The invention provides an automated security inspection and conveying system for in-transit objects, comprising means for identifying the sender of each package and to profile and import the security status data relevant to the object into the system, and a plurality of various security screening machines in combination with conveying and sorting components. The system tracks each package from a reception point through the conveyors and screening machines to reach a sorting junction, via a user-adjustable screening process, the conveying and sorting components being interfaced with the security status data for assigning a risk assessment factor to the object and the sender. Each package is routed via an appropriate number of screening devices, the output of the screening devices being processed and the risk assessment factor being adjusted accordingly, the new risk assessment factor being sent to a control system of the conveying and sorting components.

Owner:SECURELOGIC

Patient data triggered system for risk transfer linked to prolonging independent living by elderly illness occurrence and corresponding method thereof

PendingUS20170301032A1Improve system stabilityImprove stabilityFinancePatient-specific dataPaymentRisk exposure

A resource pooling system and method for multi-pillar triggered risk transfer associated with prolonged independent living under elderly illness occurrence by providing dynamic self-sufficient risk protection for a variable number of risk exposure components by the resource pooling system. The risk exposure components are connected to the resource pooling system by a plurality of payment receiving devices configured to receive and store payments from the risk exposure components for the pooling of their risks and resources. The resource pooling system includes a filter device configured to capture age-related parameters of risk exposure components and filter risk exposure components associated with an age-related parameter greater than a predefined age-threshold value by the predefined age-threshold value.

Owner:SWISS REINSURANCE CO LTD

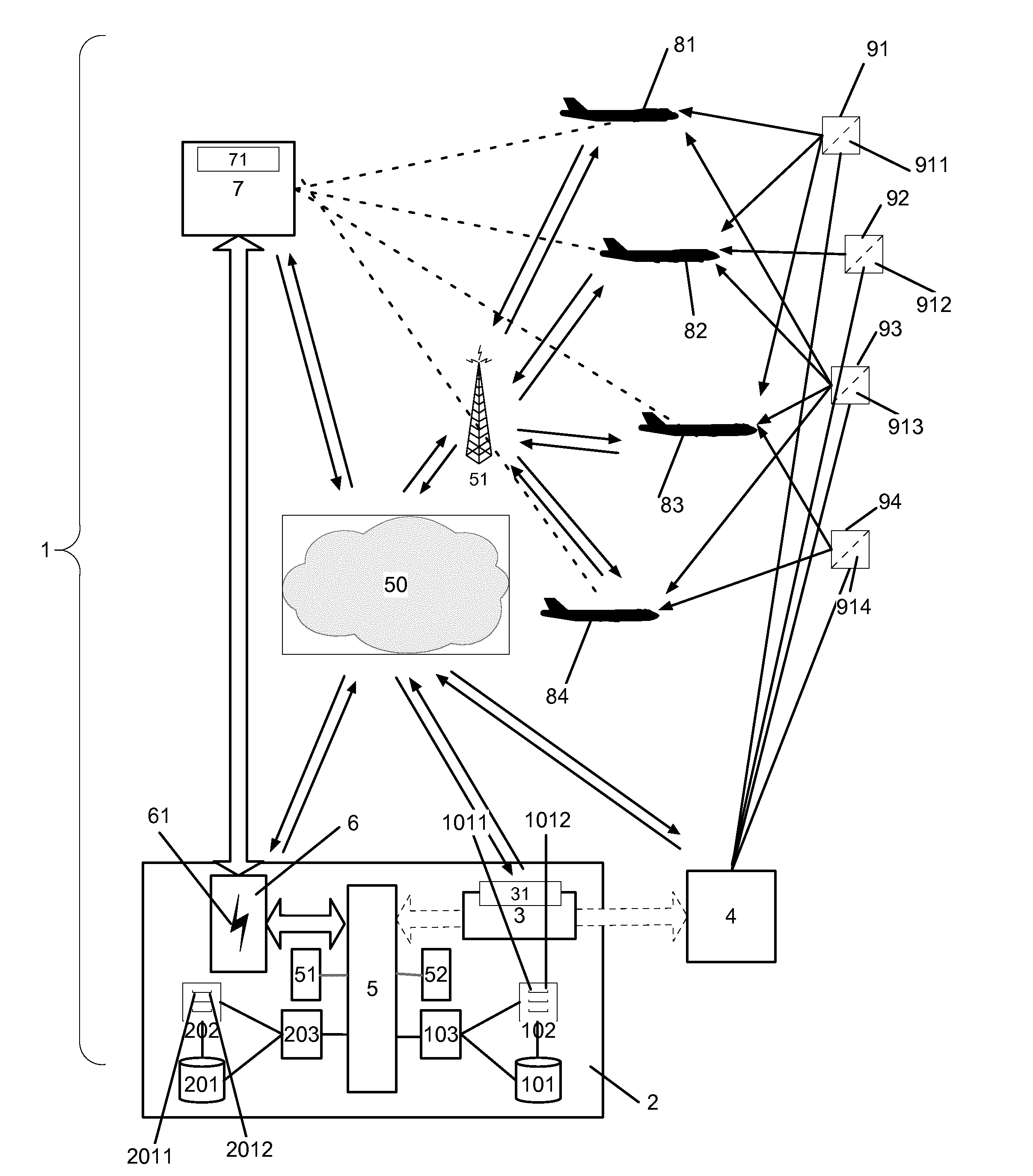

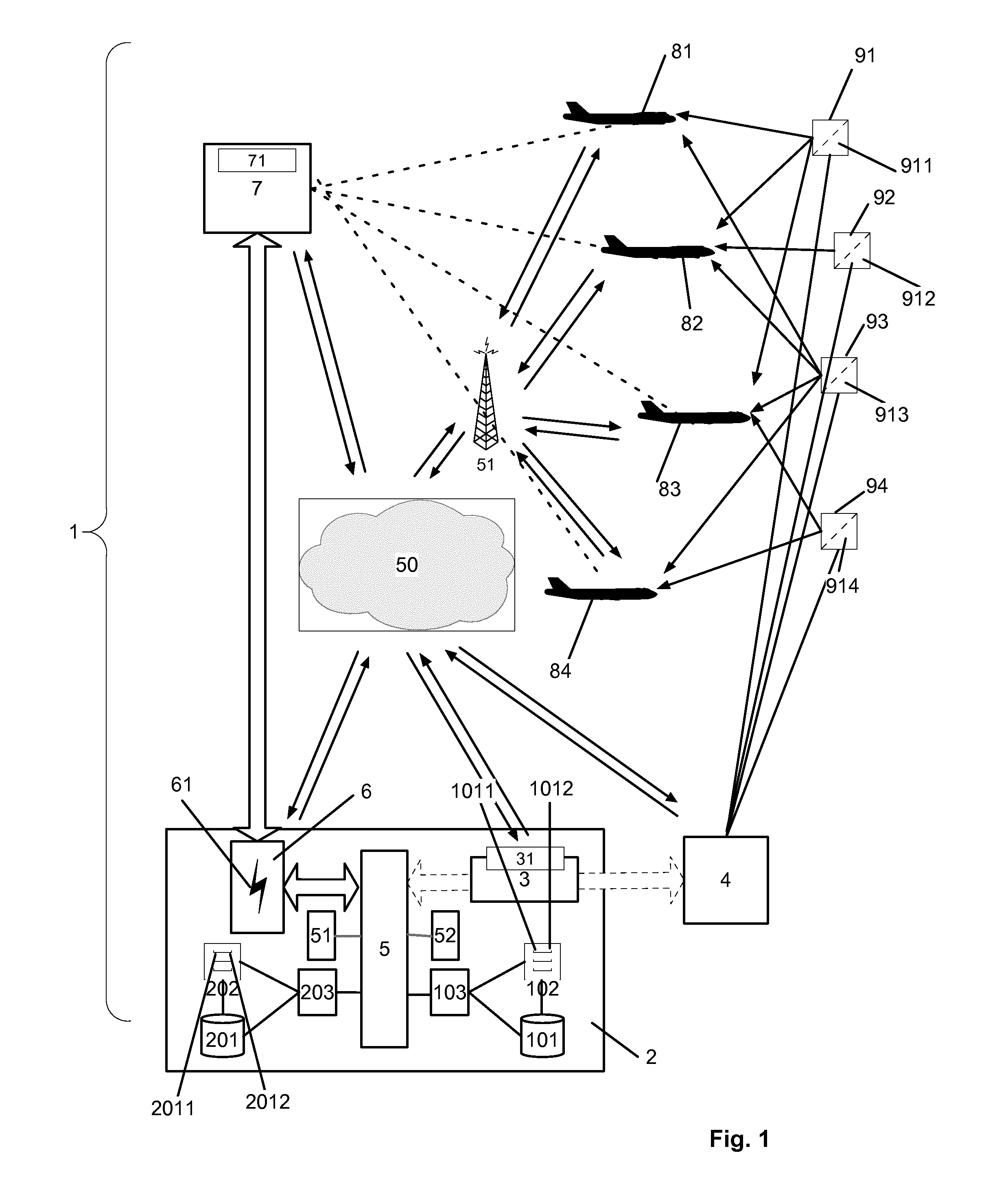

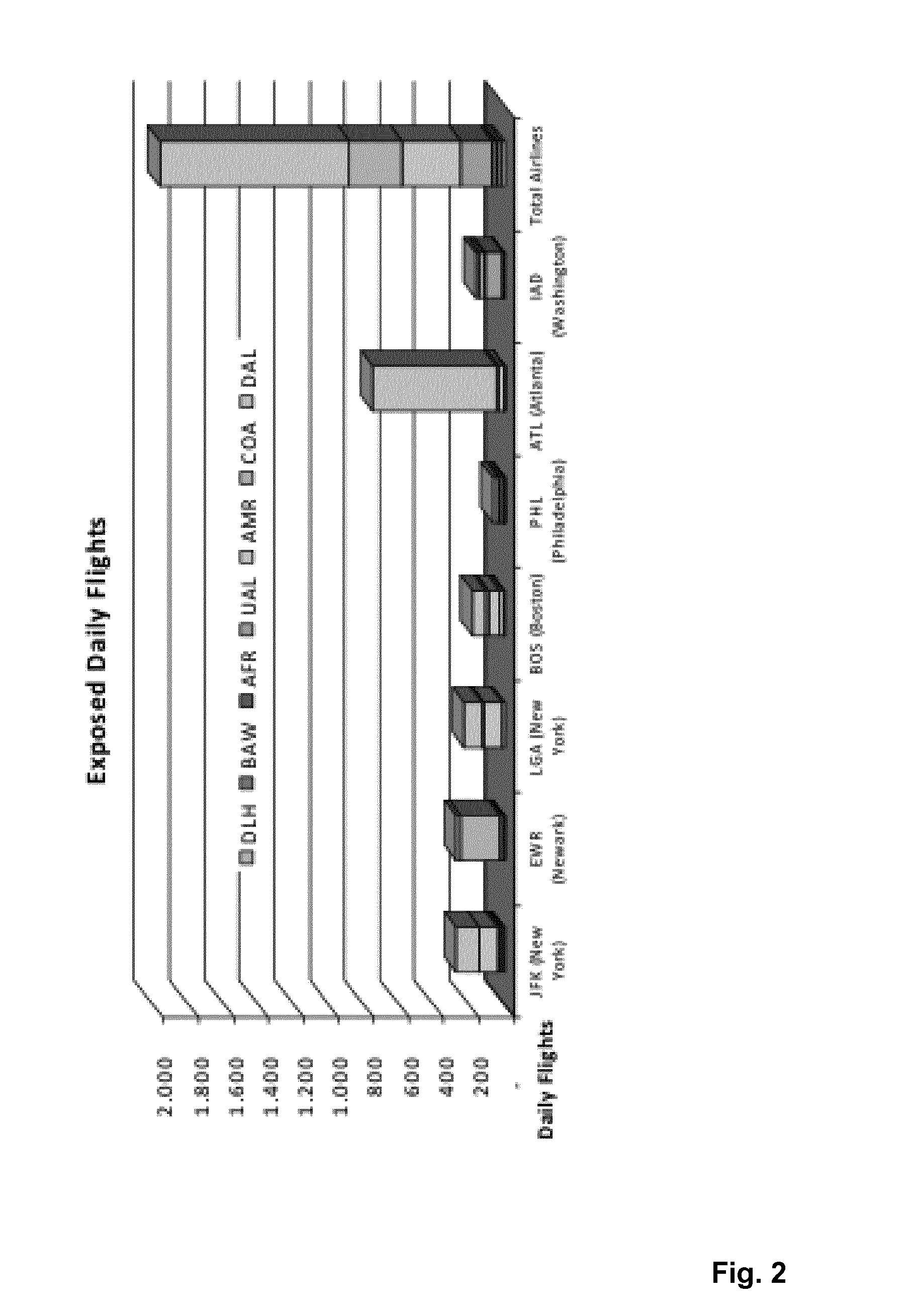

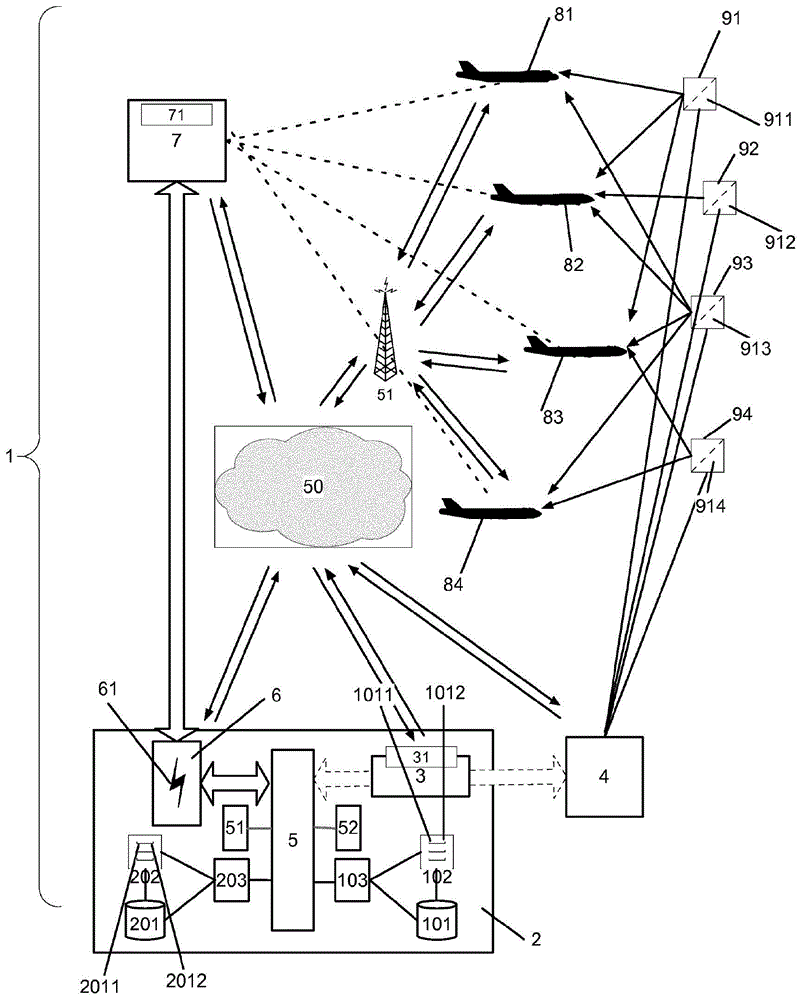

Self-sufficient resource-pooling system for risk sharing of airspace risks related to natural disaster events

The invention relates to a self-sufficient resource-pooling system (1) for risk sharing of a variable number of risk exposed aircraft fleets (81, . . . , 84) related to airspace risks, wherein resources of the risk exposed aircraft fleets (81, . . . , 84) are pooled by the system (1) and a self-sufficient risk protection is provided for the risk exposed aircraft fleets (81, . . . , 84) by means of the system (1) preventing imminent grounding or operational collapse as a consequence of an occurrence of a natural disaster events, such as volcanic eruptions. The risk exposed aircraft fleets (81, . . . , 84) are connected to the system (1) by means of a plurality of payment-receiving modules configured to receive and store payments from the risk exposed aircraft fleets (81, . . . , 84) for the pooling of their risks and resources and loss cover is provided based on the pooled resources and risks by means of the system (1).

Owner:SWISS REINSURANCE CO LTD

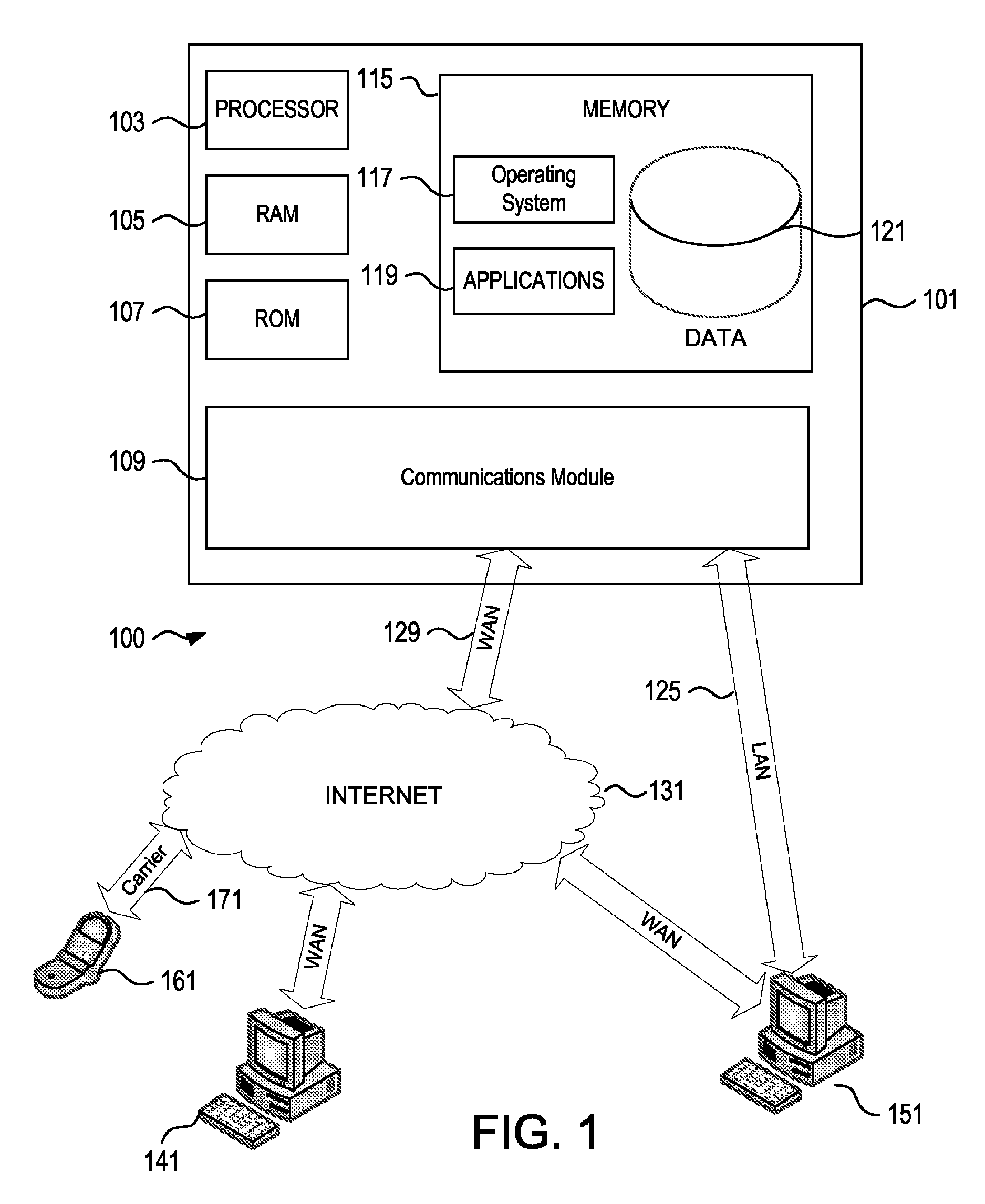

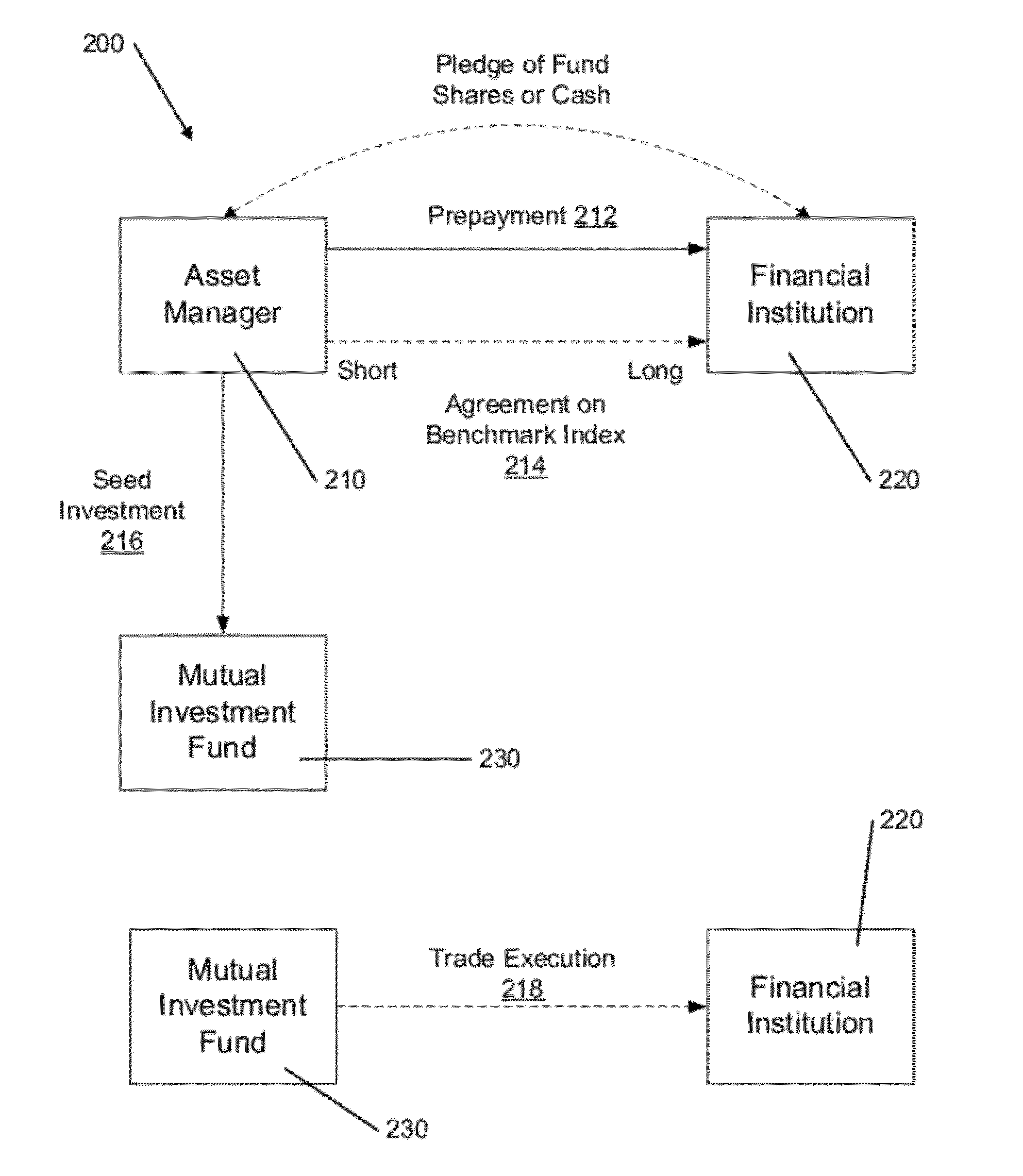

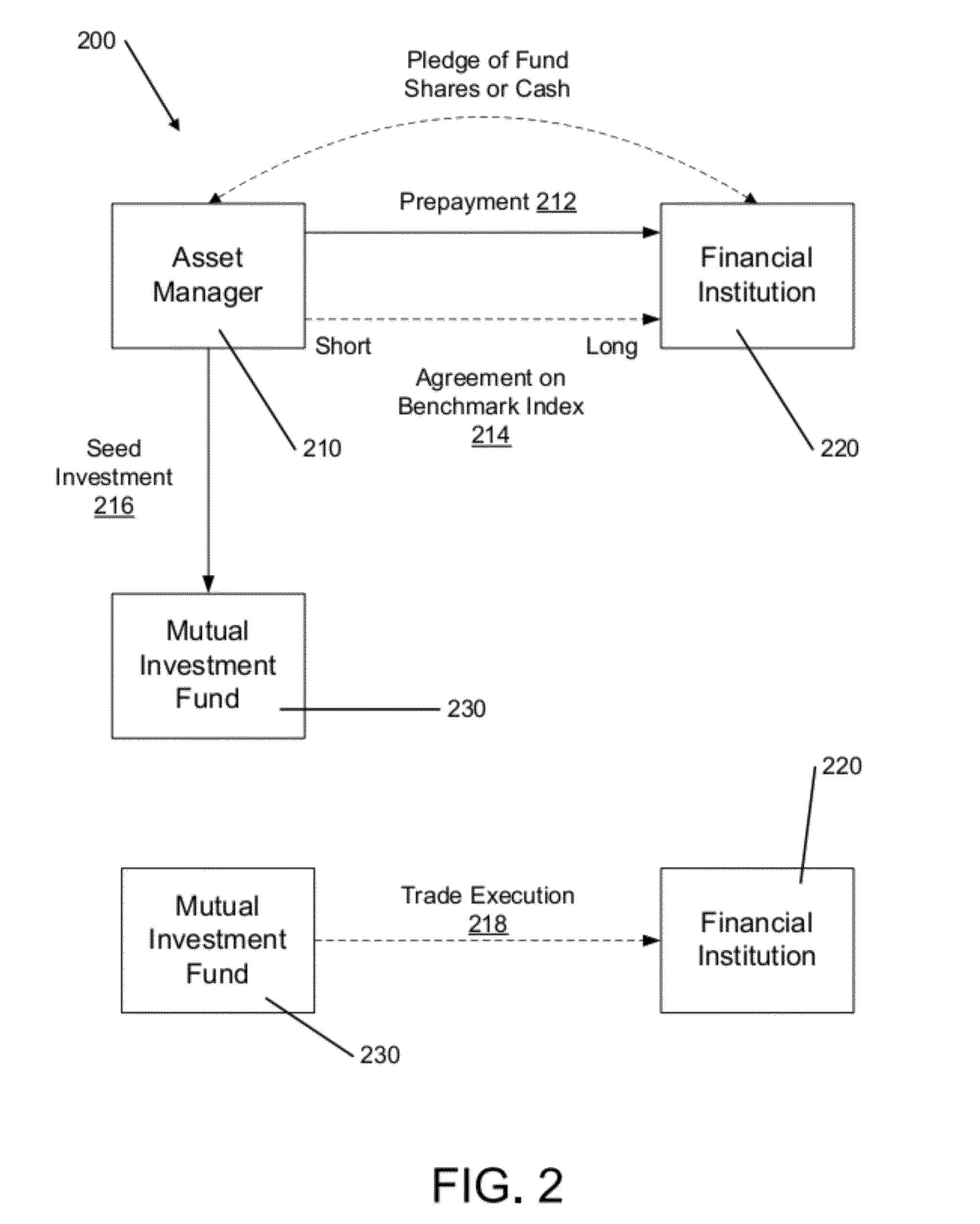

Systems for structured investment seeding

Owner:BANK OF AMERICA CORP

Off-line compliance security audit method of IT simulation infrastructure

InactiveCN102427445BDoes not interfere with normal operationImplement a safety planData switching networksIT riskNetwork topology

The invention relates to a safe auditing method of IT simulation infrastructure offline compliance. The method comprises the following steps: collecting configuration information; introducing / establishing a network topology; selecting verification / auditing rules; operating a test; generating a report; and correcting configuration or a model. Beneficial effects of the invention are as follows: IT risk localization and risk management are provided for a client as well as an intelligent analysis and automatic monitoring are also provided for the client; end-to-end auditing analyses can be carried out on network equipment, a wide area network link and a local area network link; a potential instable factor can be discovered in advance; rapid and accurate auditing and analyses can be carried out on a whole network infrastructure, so that a safe plan can be realized; besides, during the detection by the method in the invention, normal operation of an existing network will not be interfered; high security can be provided for an existing production network; and there is no potential or direct risk.

Owner:北京随方信息技术有限公司

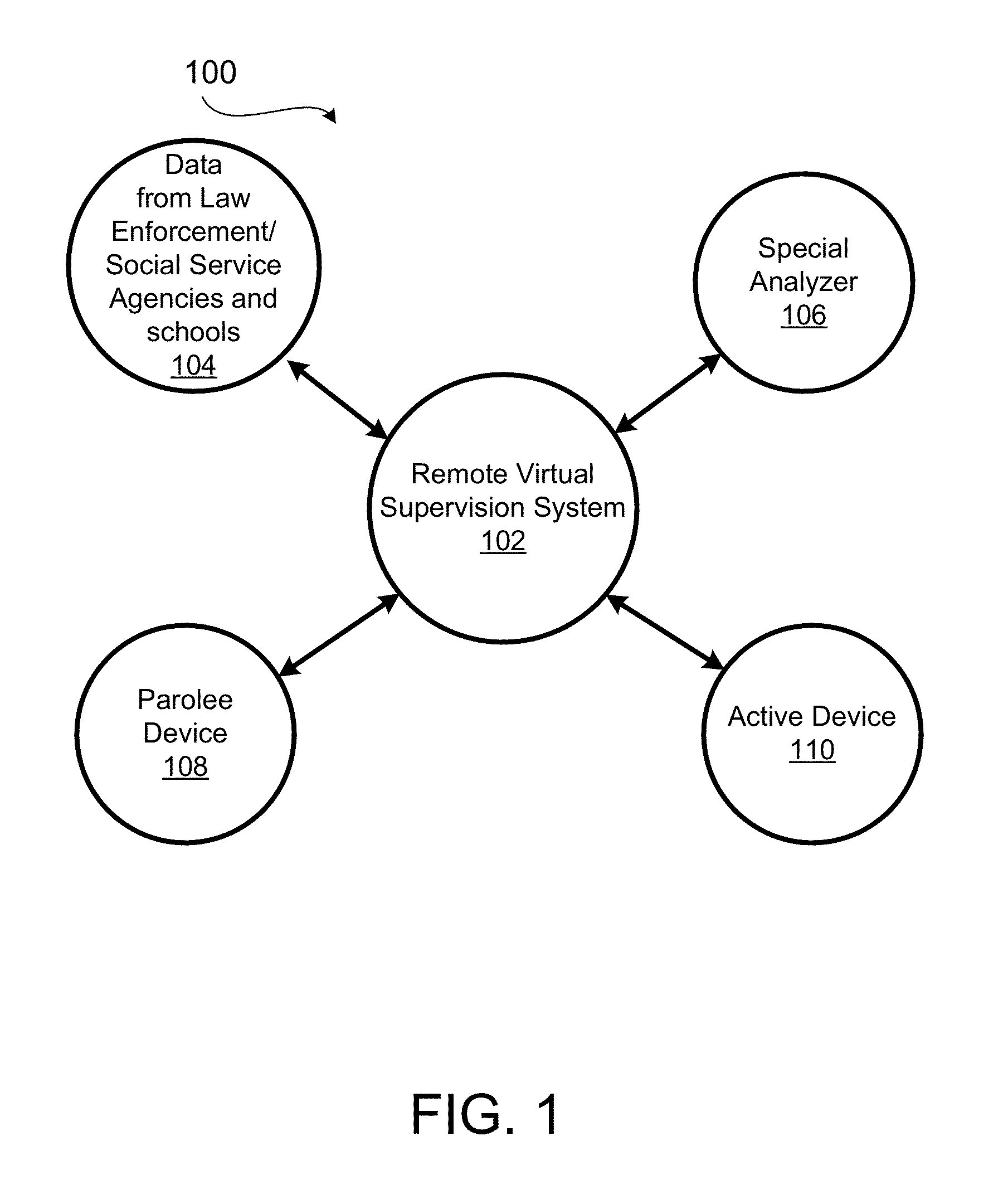

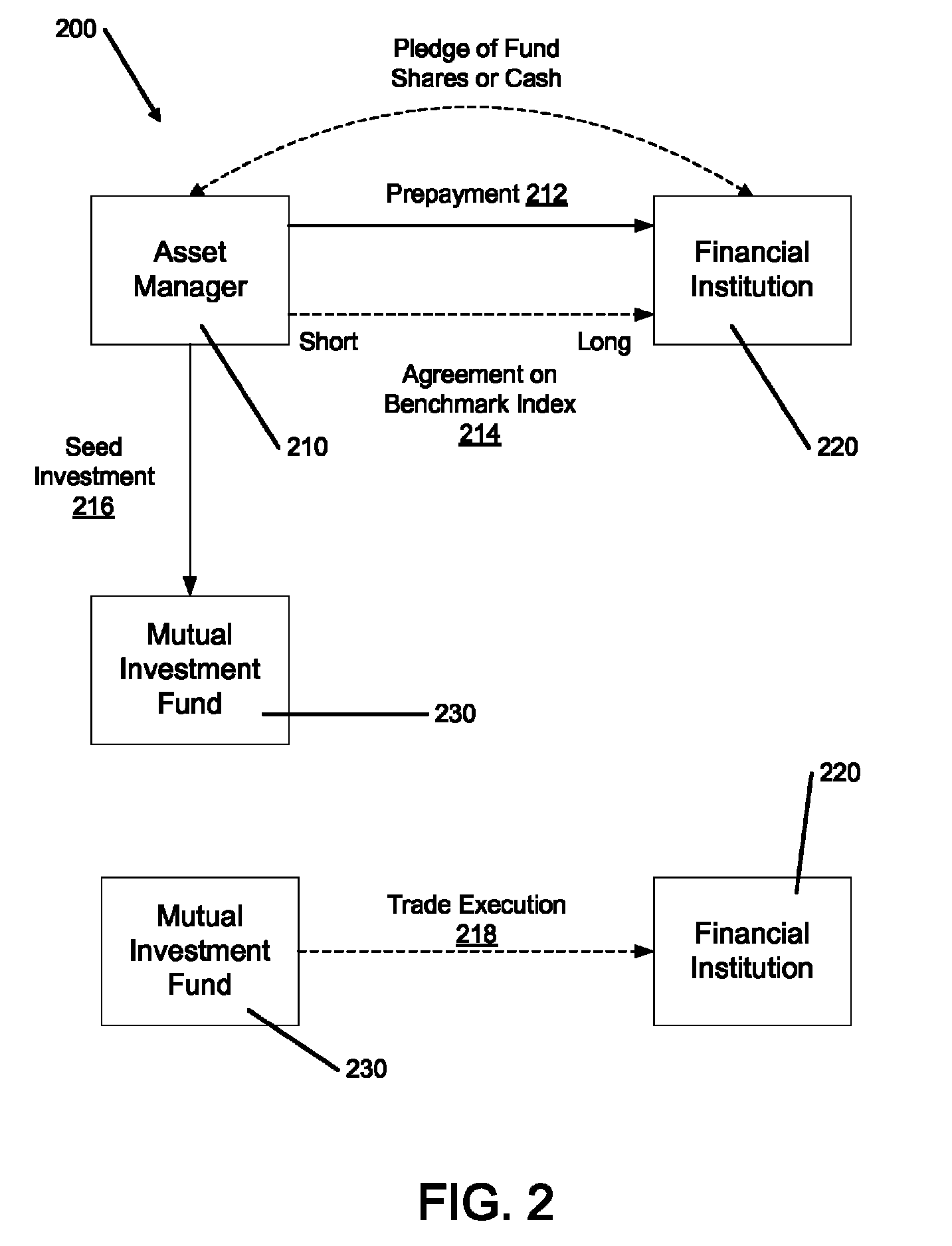

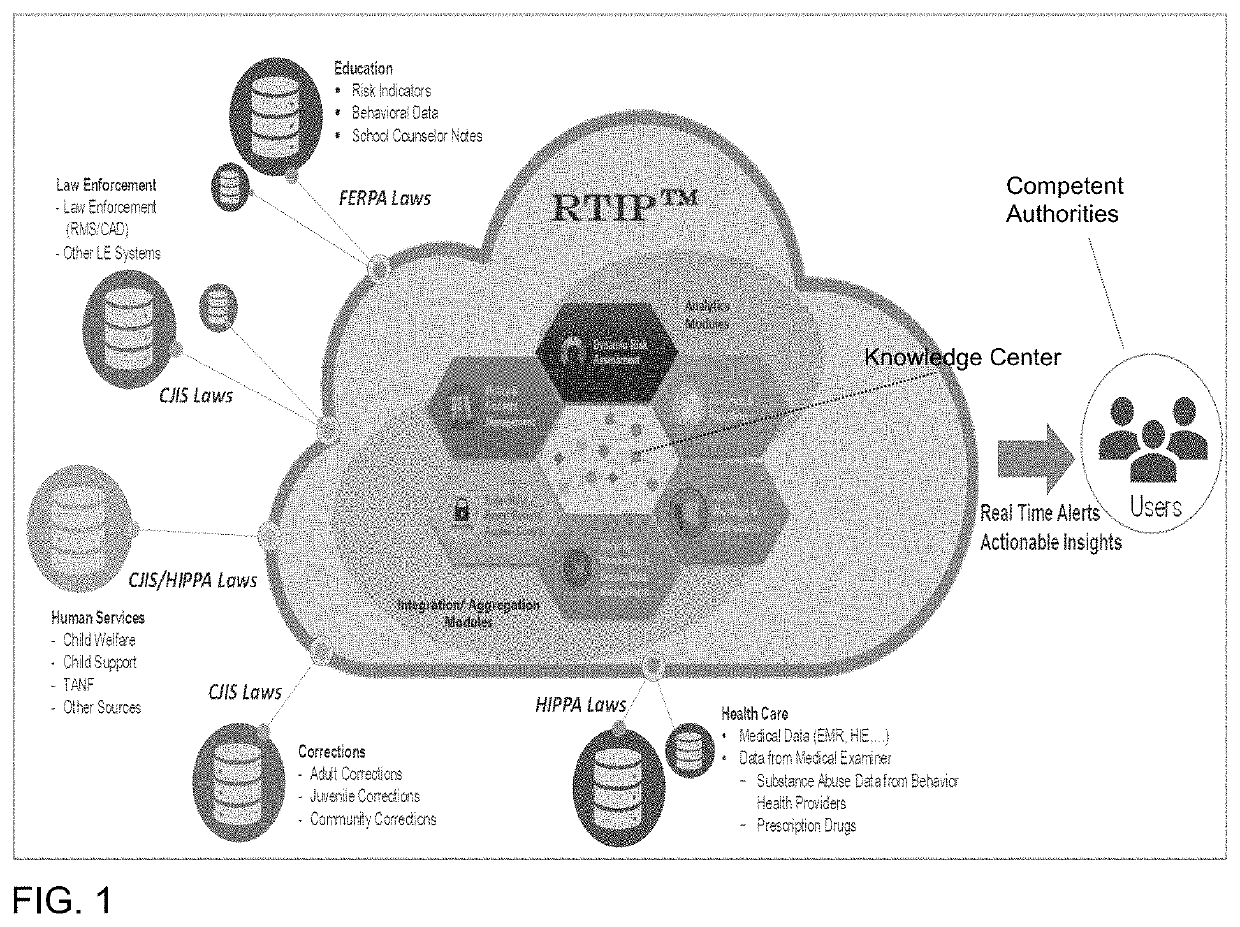

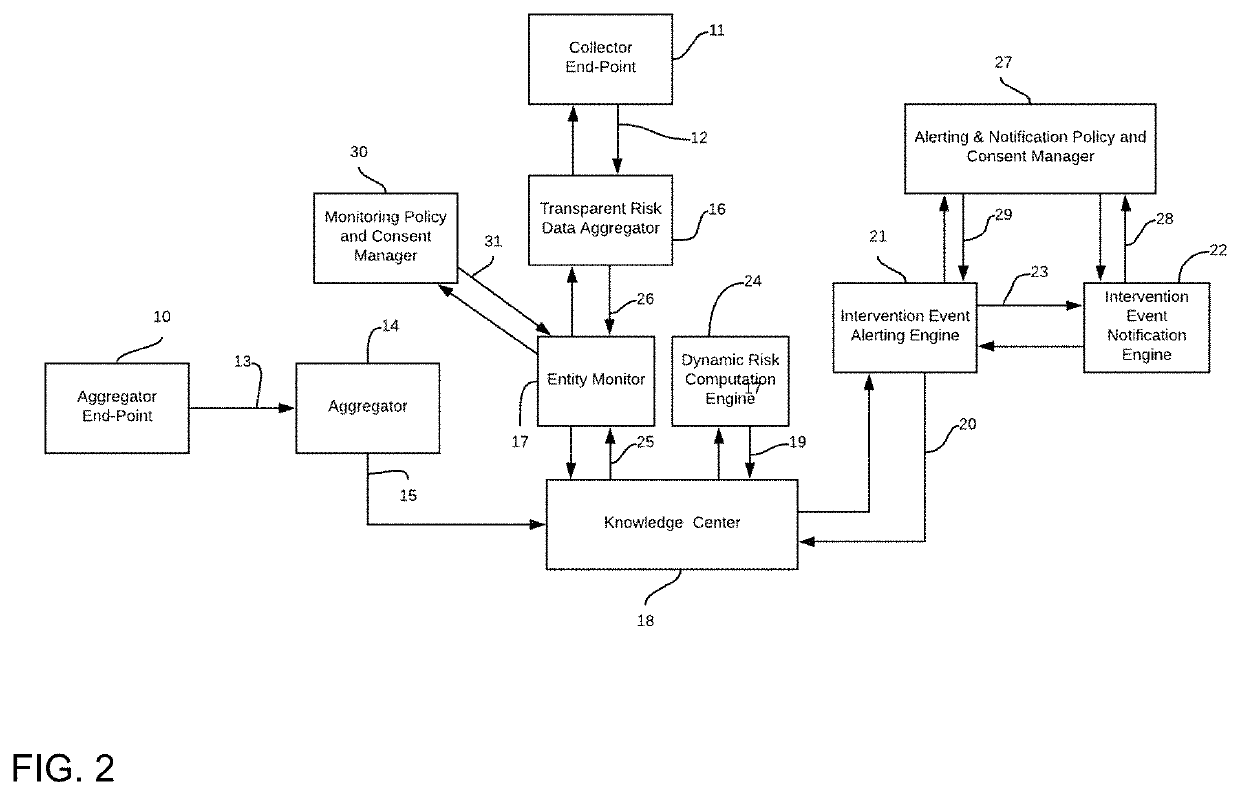

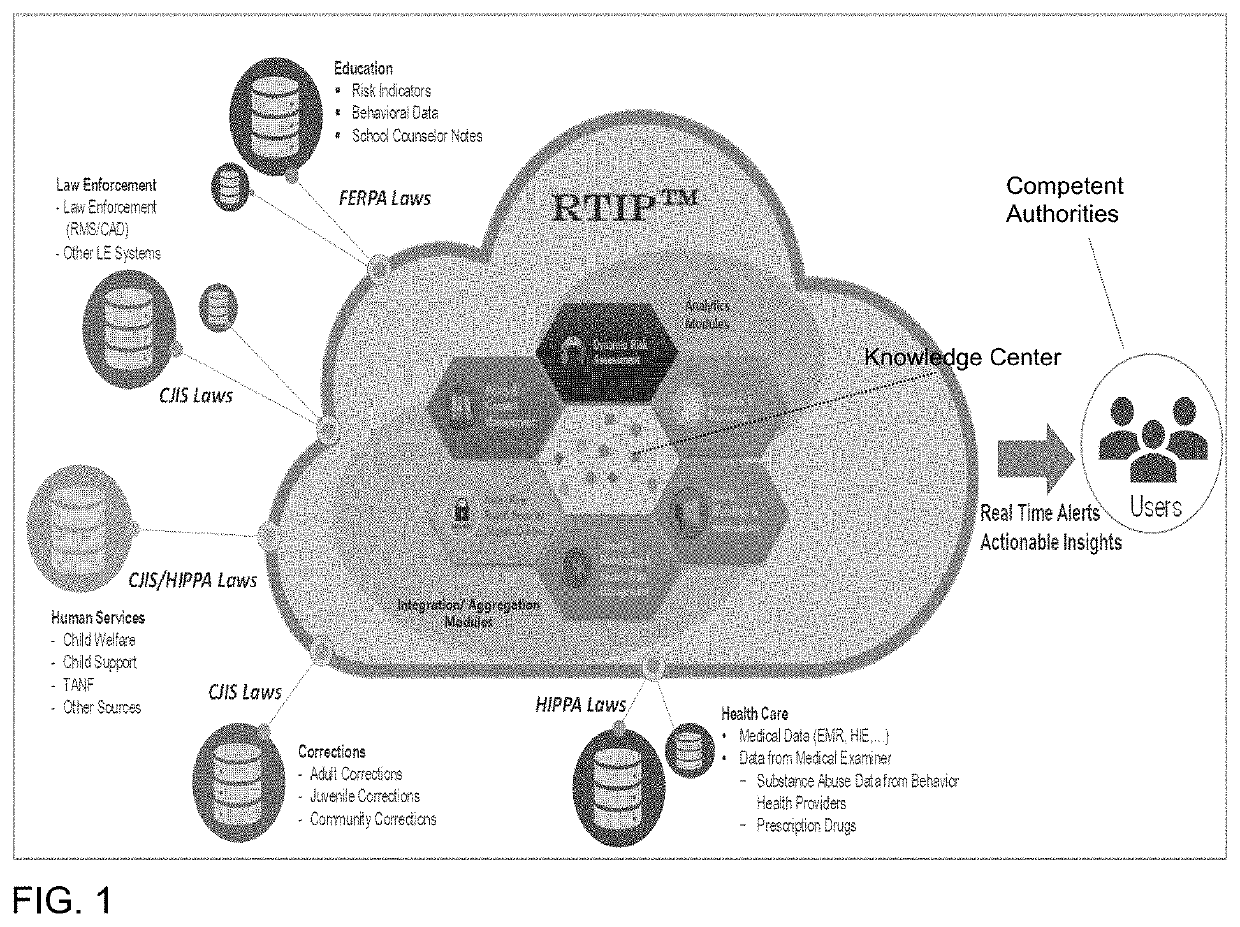

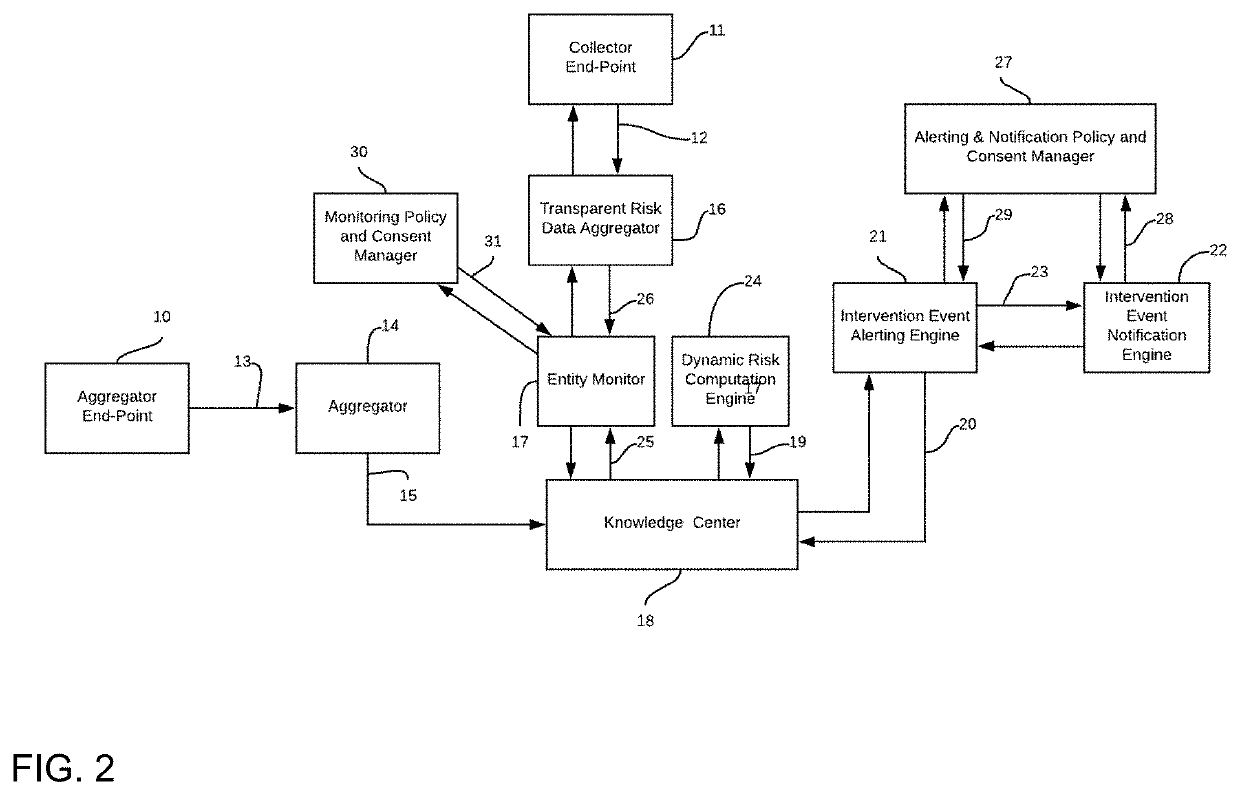

Real time intervention platform for at-risk conduct

A system for generating automated notifications by aggregating data to provide alerts to interdict at-risk conduct. In the system, an aggregator application accesses a plurality data sources addressing at-risk conduct. The aggregator application generates reports of incidents of at-risk conduct by specific individuals and stores the reports in a database. A dynamic risk computation engine scores each individual for their risk of engaging in at-risk conduct according to metadata on contacts of that individual within the plurality of data sources. Any individual having a score exceeding a pre-determined threshold triggers an alarm and a notification is provided in real time to competent authorities to allow a responsible person to make a timely intervention.

Owner:TETRA VENTURES LLC

Real time intervention platform for at-risk conduct

A system for generating automated notifications by aggregating data to provide alerts to interdict at-risk conduct. In the system, an aggregator application accesses a plurality data sources addressing at-risk conduct. The aggregator application generates reports of incidents of at-risk conduct by specific individuals and stores the reports in a database. A dynamic risk computation engine scores each individual for their risk of engaging in at-risk conduct according to metadata on contacts of that individual within the plurality of data sources. Any individual having a score exceeding a pre-determined threshold triggers an alarm and a notification is provided in real time to competent authorities to allow a responsible person to make a timely intervention.

Owner:TETRA VENTURES LLC

Systems for structured investment seeding

Owner:BANK OF AMERICA CORP

Global treasury monitoring system

A global treasury monitoring system can provide a single centralized system of record for maintaining and updating global treasury limits to enable an organization to consistently allocate, apply and manage such limits across multiple types of platforms. Through a single system of record for the management of global treasury limits, an organization may comprehensively assess its risk exposure at any given time and make adjustments to limits on a real-time basis in response to rapidly-changing market conditions. The global treasury monitoring system can provide an organization with the ability to access, evaluate and reconfigure recorded treasury limits in real-time through various graphical user-interfaces (GUIs) accessible to users at various global locations. As treasury limits are utilized the system may update the availability of such limits so that an organization's risk exposure may be constantly monitored and assessed. The system also provides an organization with additional flexibility in programming a client's treasury limits to match the client's various liquidity needs around the globe while also managing the amount of the risk that the organization is willing to take on to attain appropriate returns.

Owner:BANK OF AMERICA CORP

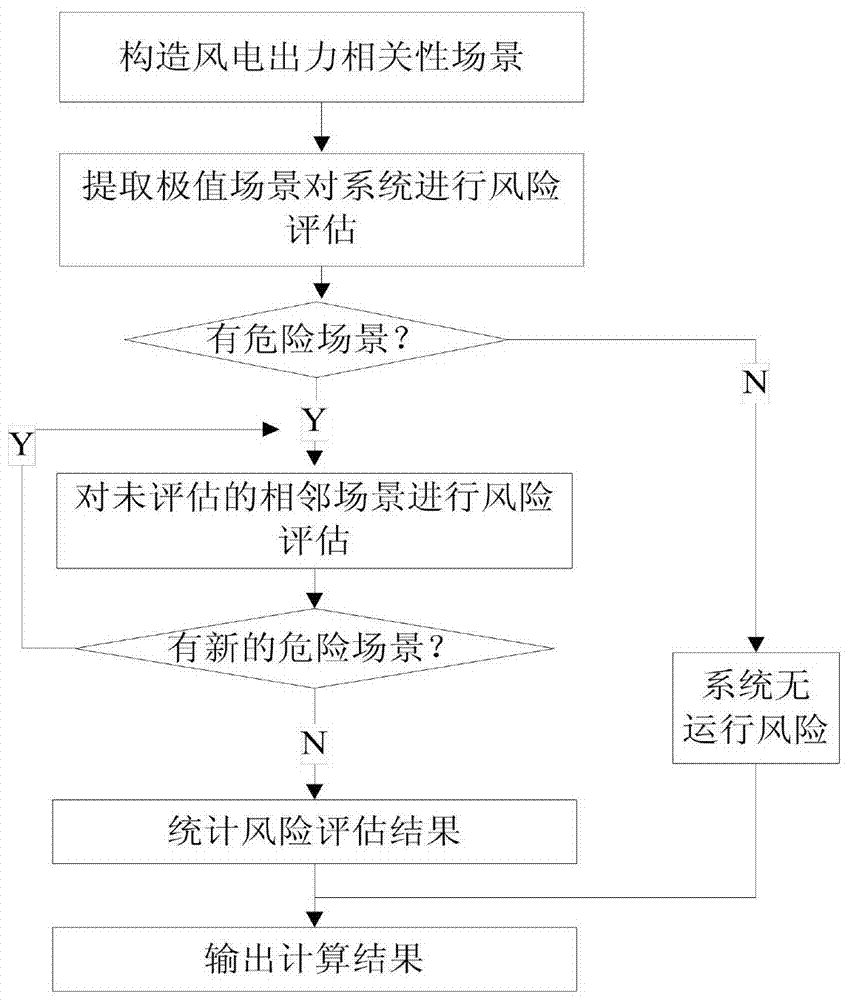

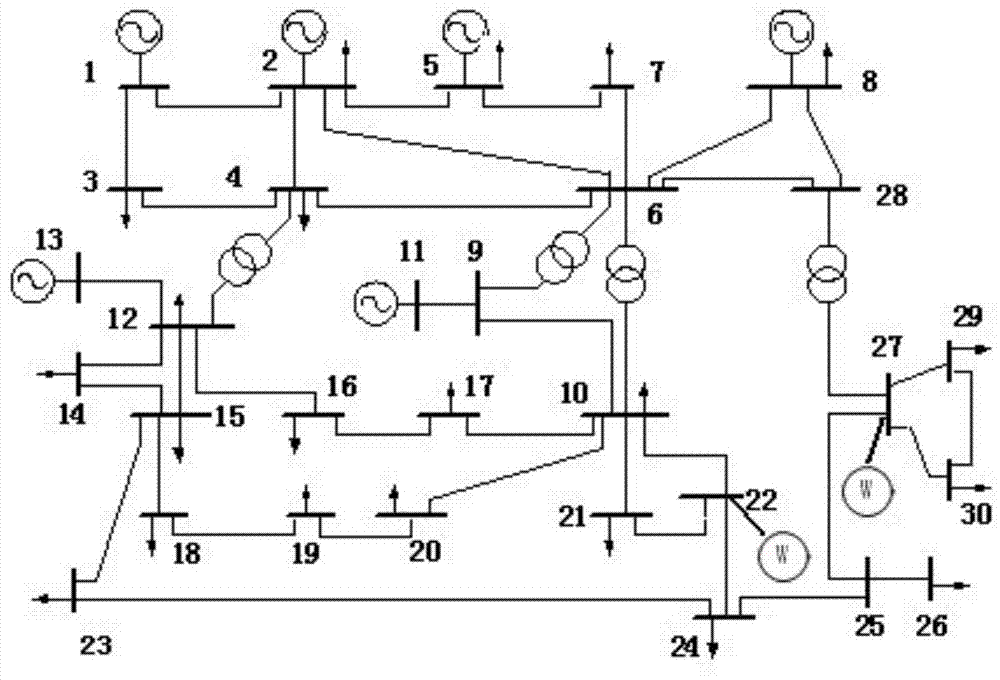

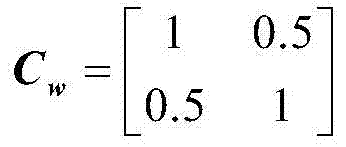

A Method of Power System Risk Assessment Based on Static Security Domain

ActiveCN104156614BHigh speedAvoid redundant calculationsSpecial data processing applicationsElectricityElectric power system

The invention provides a static safety domain-based power system risk assessment method. This method first selects the extreme value scenarios including the extreme value of wind farm output from the wind power output scenarios, and uses the extreme value scenarios to carry out risk pre-assessment on the power system. If no operational risk is found in the pre-assessment, the system can be considered safe and there is no need to use other scenarios for evaluation; Get accurate assessment results for all hazardous scenarios. While ensuring the accuracy of risk assessment, this method saves a large number of redundant calculations in security scenarios, improves the speed of risk assessment, and provides a time guarantee for timely discovery of potential risks in system operation.

Owner:STATE GRID CORP OF CHINA +3

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com