Patents

Literature

48 results about "It investment" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

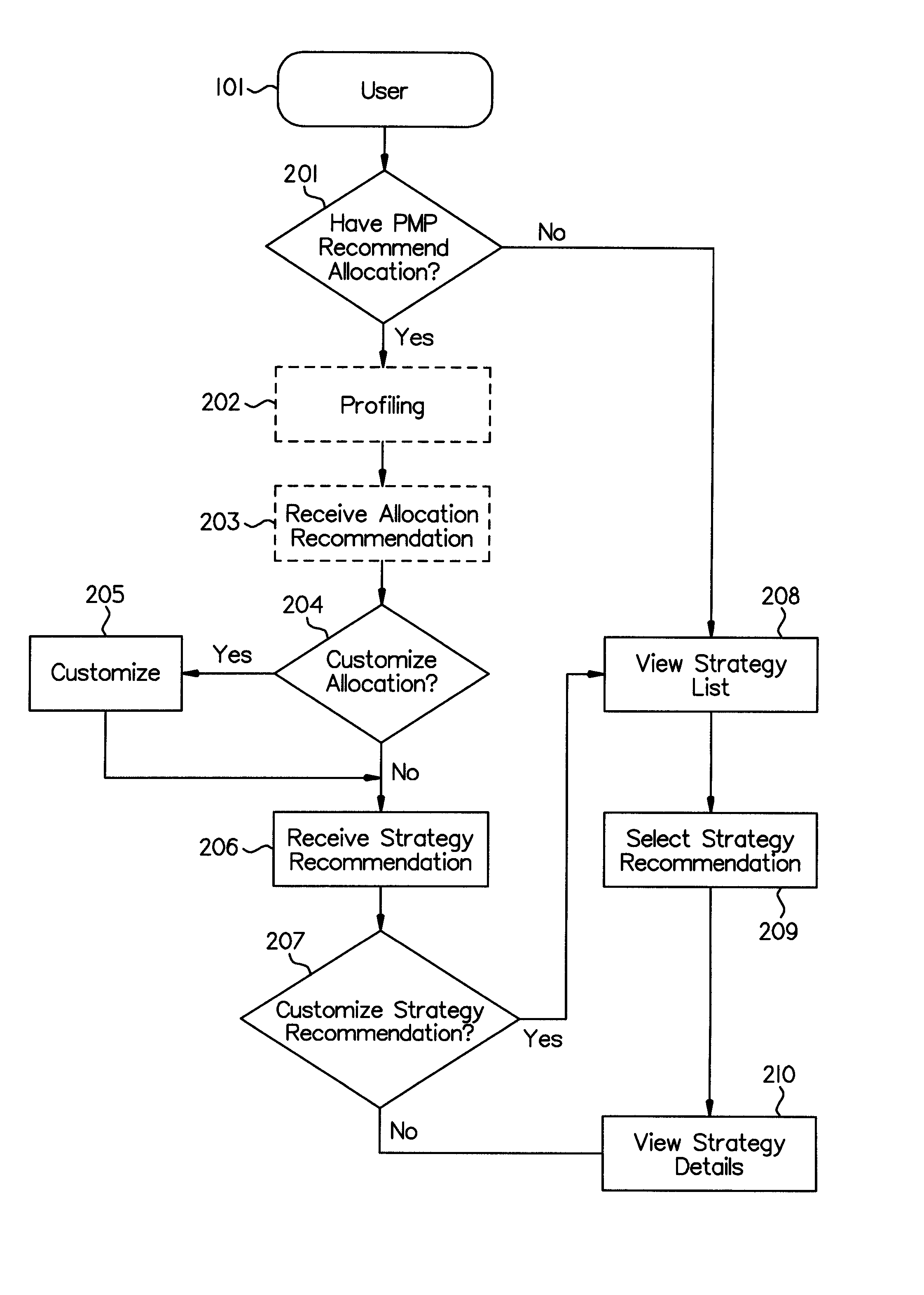

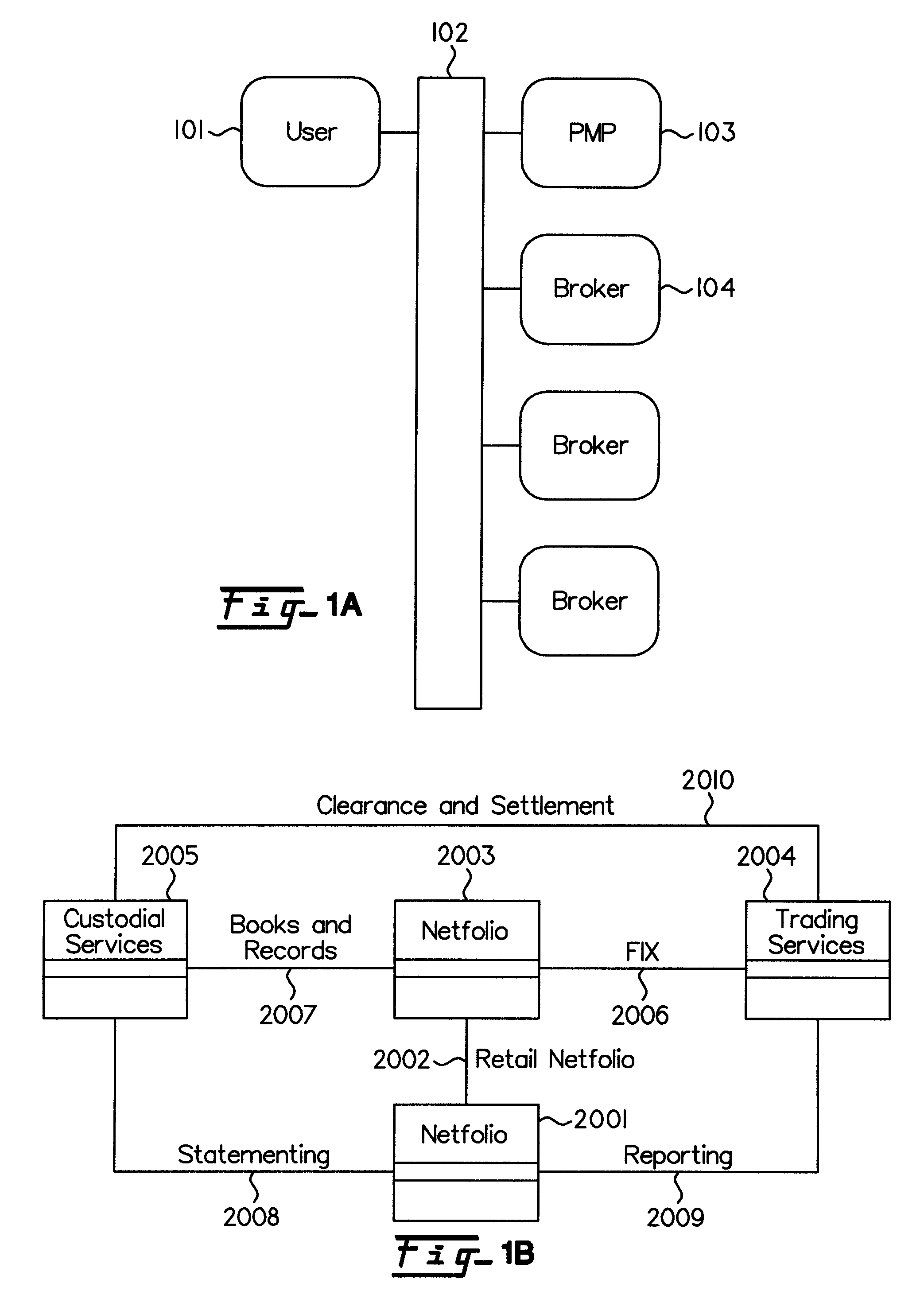

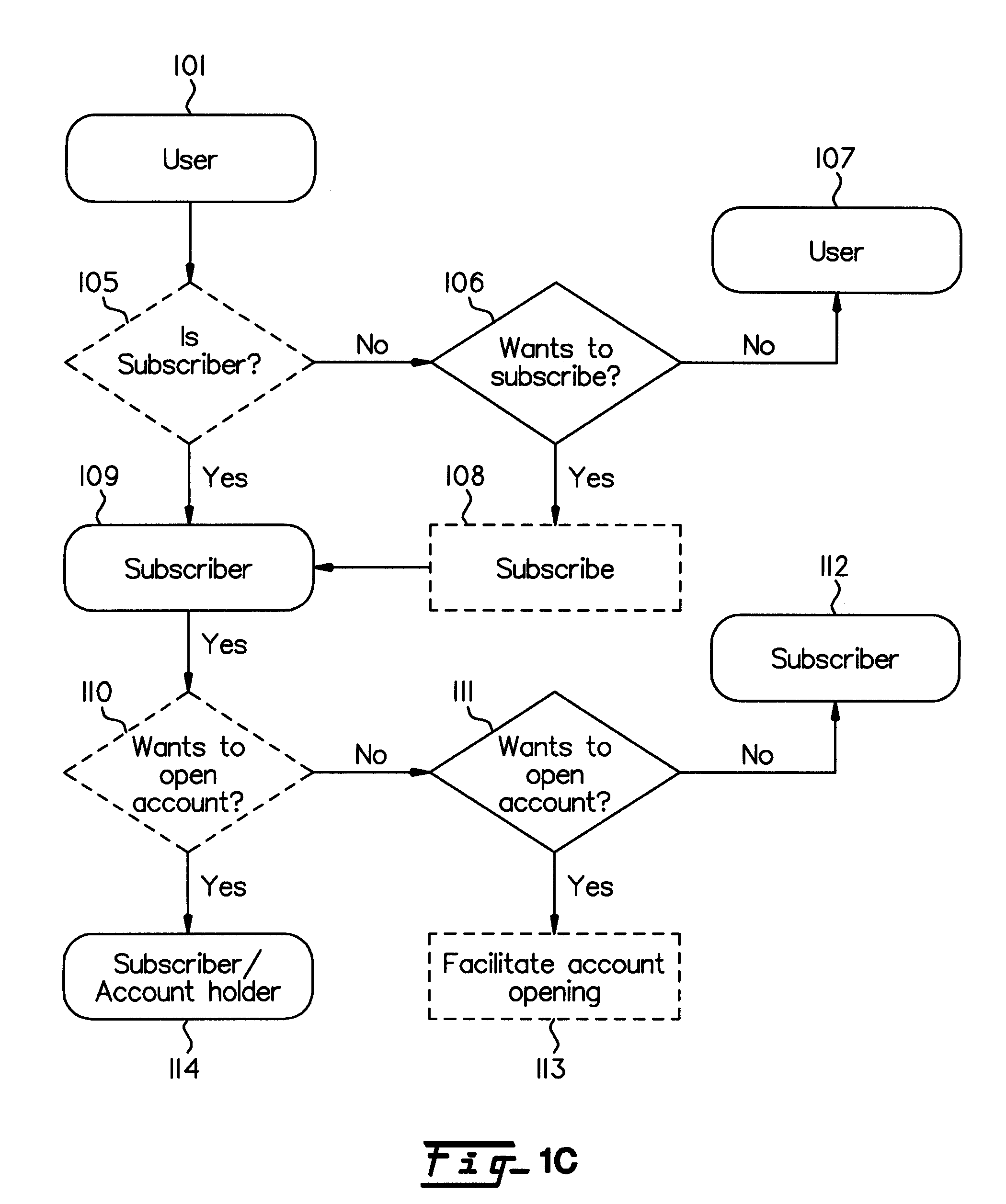

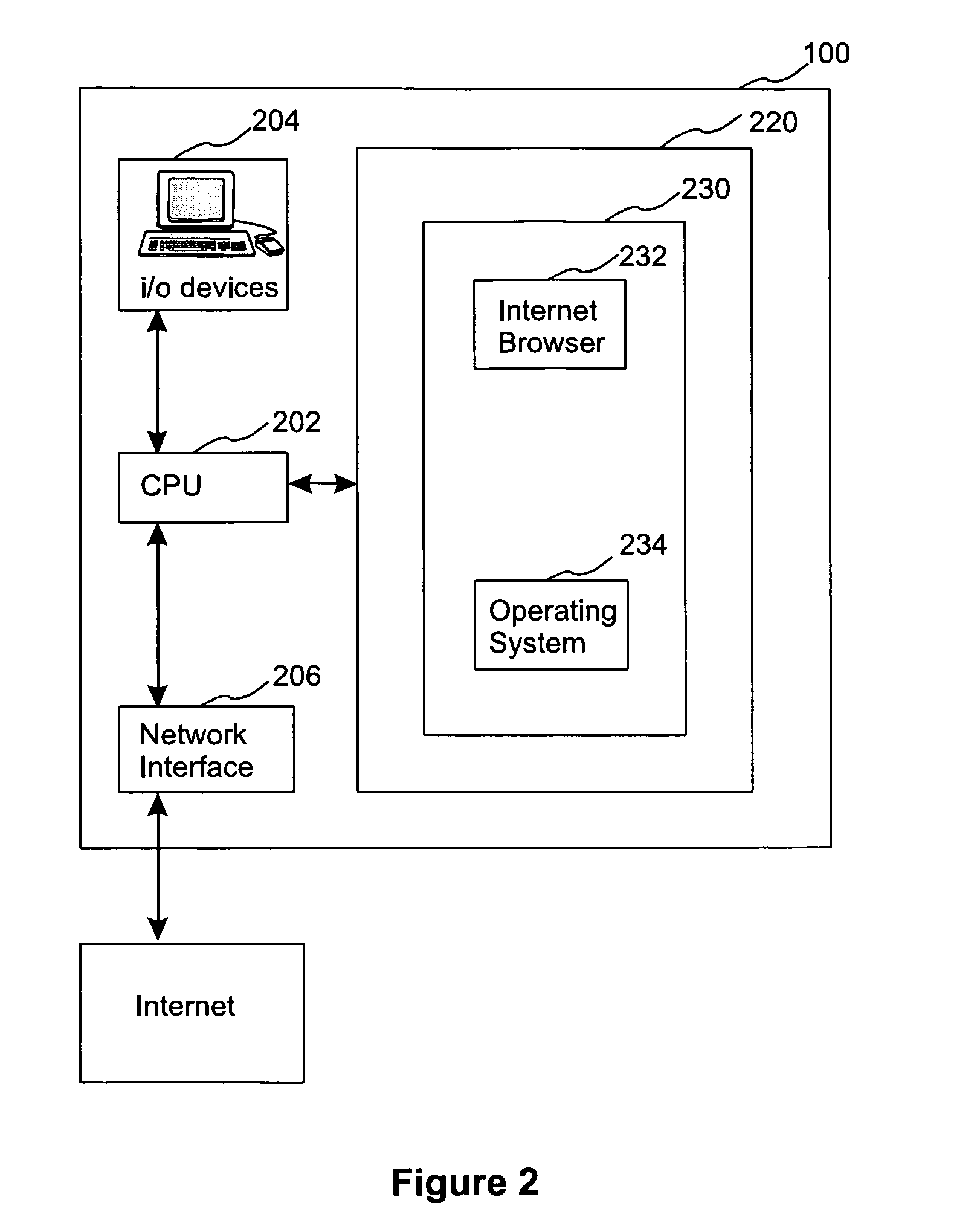

System for selecting and purchasing assets and maintaining an investment portfolio

The invention is in the field of using a computer to provide automated investment allocation advice, selection of investment securities, customization of the automated advice, execution of investment securities, maintenance / monitoring of investment portfolios and rebalancing of investment portfolios. A user is connected to the Internet. The user connects to the portfolio management program (PMP) host computer through the Internet. The user completes a questionnaire that the PMP uses to generate a suitable investment allocation and specific portfolio strategy recommendation. The user reviews the strategy and specific information about the strategy. The information is transmitted across the Internet to the user. The information transmitted includes historic and / or hypothetical performance, historical and / or hypothetical holdings, current securities selections of the strategy, and a description of the strategy's selection methodology. The user, after making appropriate reviews, makes a decision to purchase the instruments in that portfolio. Now the user sees a list of instruments provided by the PMP host computer. The list of stocks is ordered by the degree to which they satisfy the requirements of the strategy. The user can then make the decision whether to accept, reject, or replace any individual security in the generated list or add an individual security. For example, the user can reject a security in the strategy and ask the PMP host computer to replace it with the next security that best fits. Once the user has approved the content of the proposed portfolio, the user enters an amount that the user will invest in accordance with the strategy. The PMP will allocate the investment amount across all the securities in the strategy. The user may authorize the PMP to purchase these selections through their qualified broker. The user may monitor the performance of these instruments subsequent to purchase through the PMP. The user may receive news, alerts, and / or research related materials for these instruments through the PMP. The user may authorize the PMP to rebalance their investments periodically to an updated list of instruments matching the selected strategy. The user may select a rebalance method that optimizes the tax consequences or the strategy adherence. The user has the ability to accept, reject, or replace any individual security in the generated list or add an individual security as part of the rebalance. The user can set up automatic email notification of rebalance dates or to have the PMP vote the proxy of the shares. The owner of the PMP host computer collects a payment for this service.

Owner:NETFOLIO INC

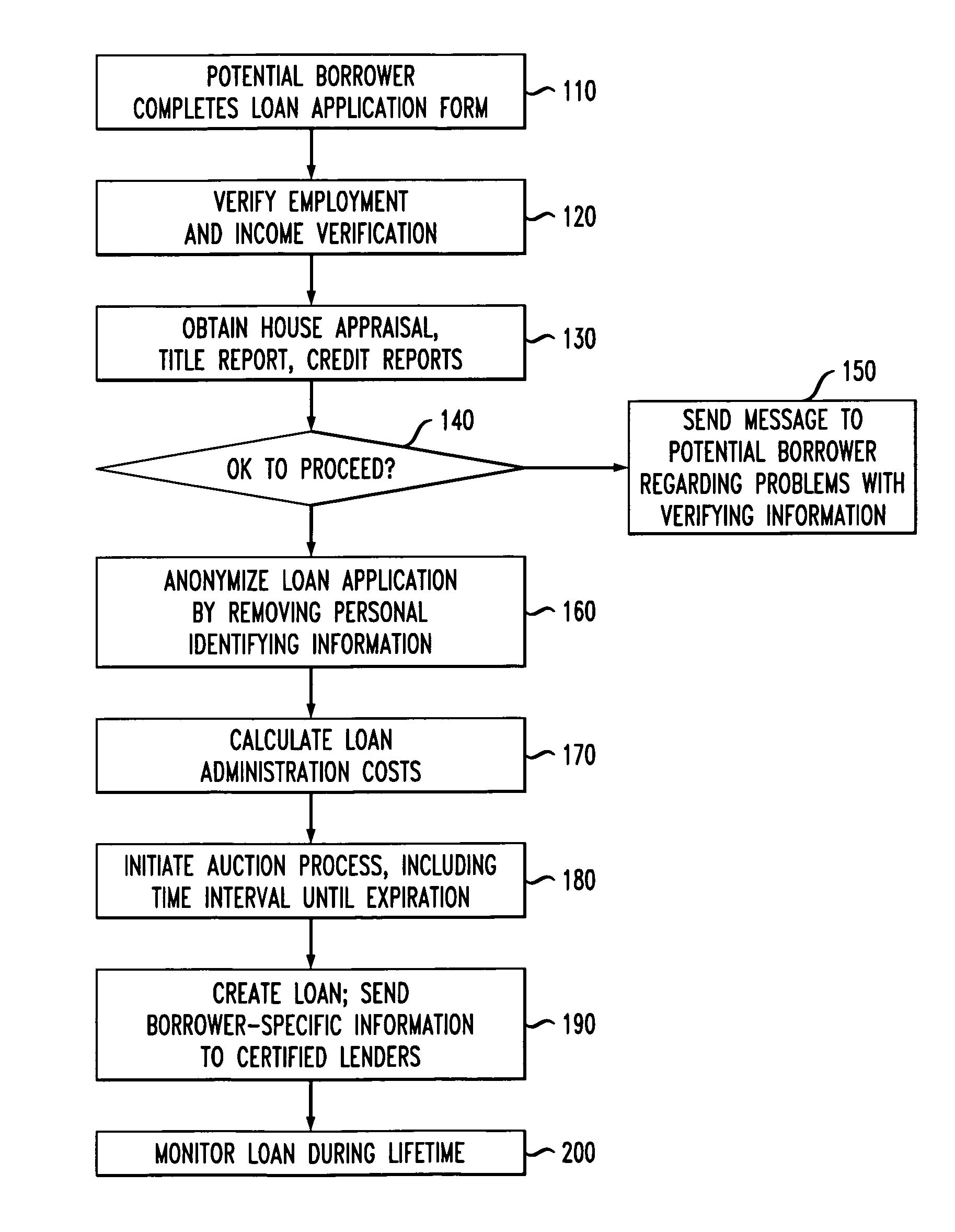

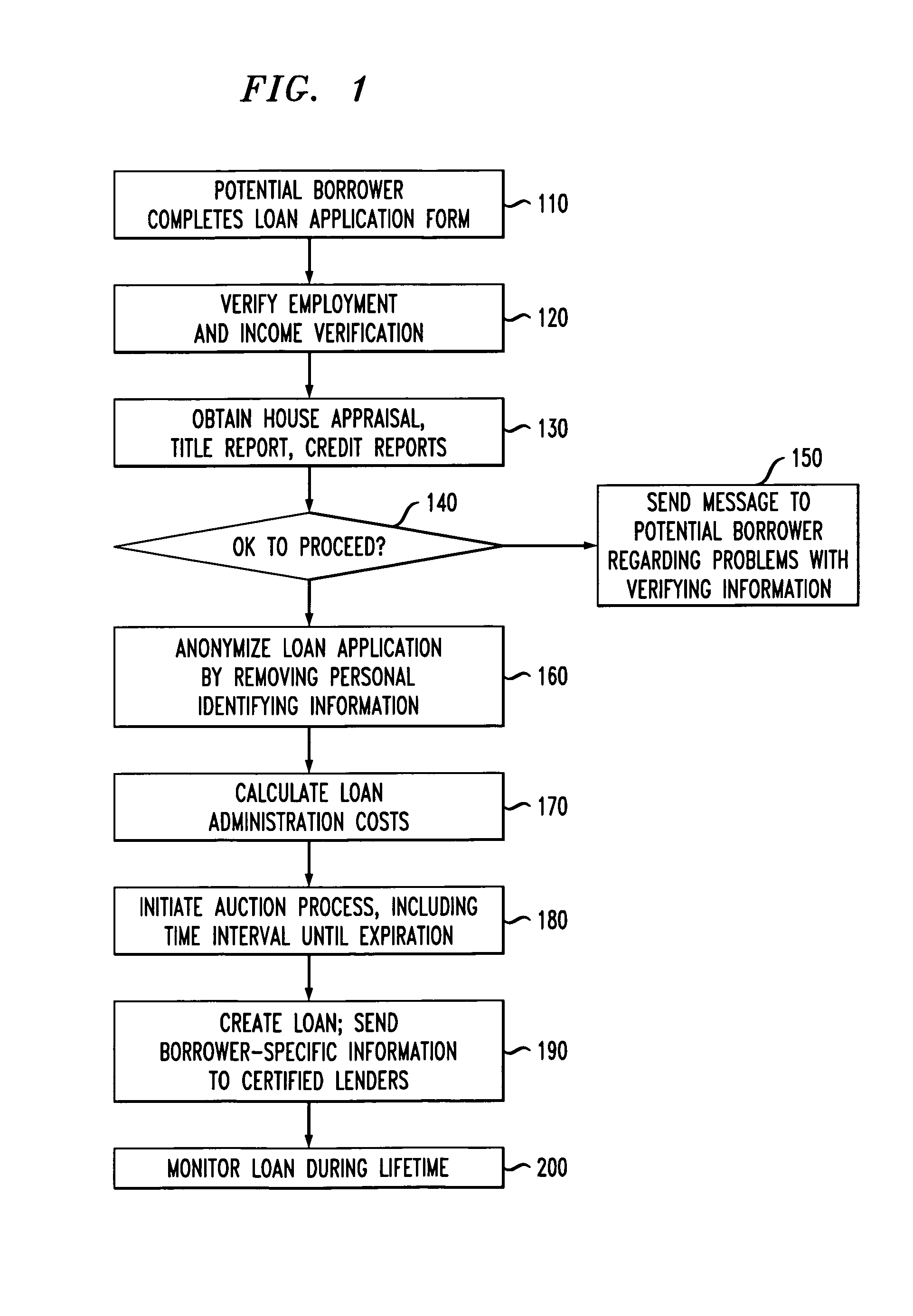

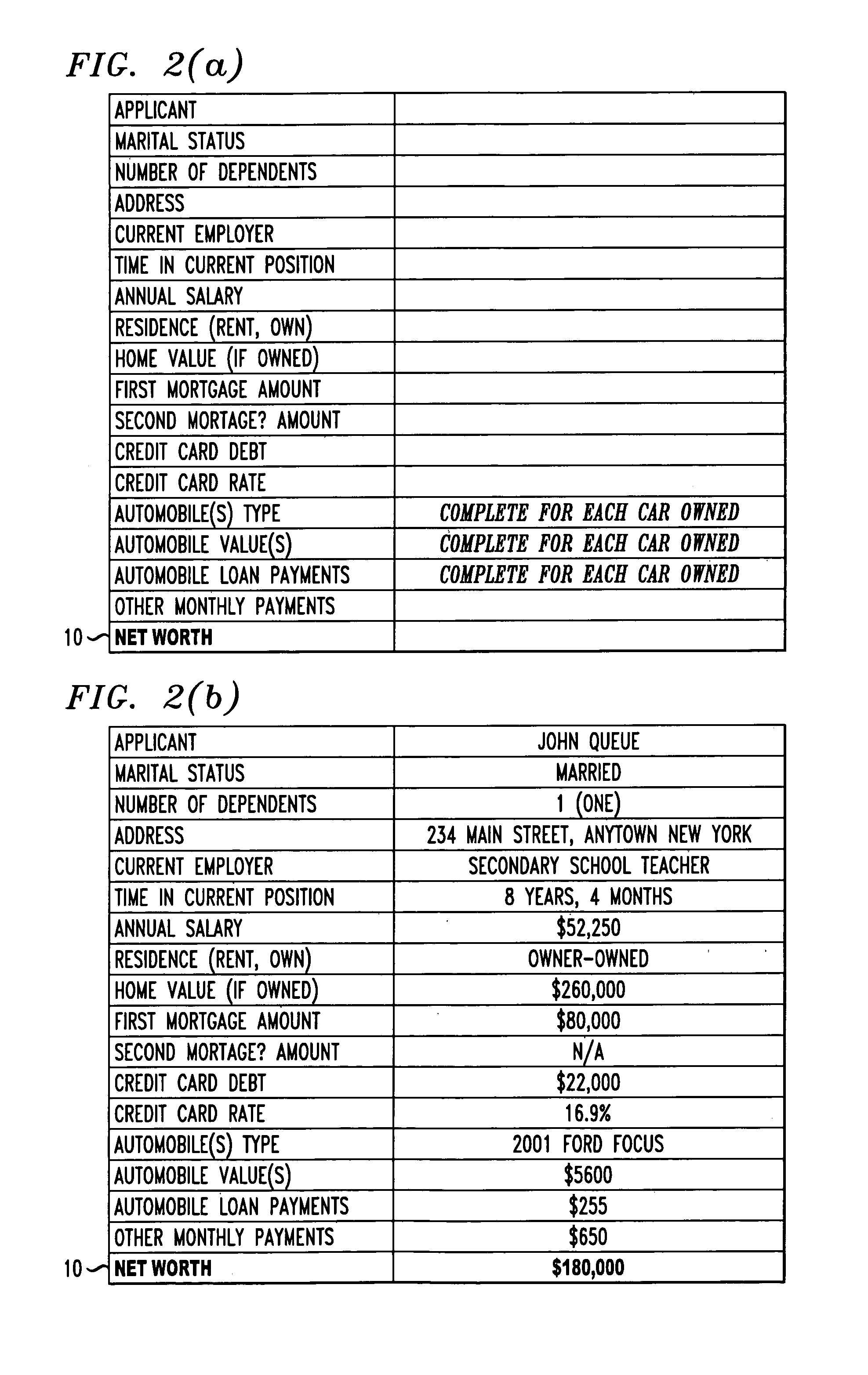

Web-based loan auctions for individual borrowers and lenders

A web-based loan auction system is available to individual borrowers and individual lenders and is particularly well-suited for individual borrowers that cannot meet the standards of conventional lending institutions. The system is also attractive to potential lenders that desire to achieve a higher return on their investment than currently offered by banks. The potential borrower submits a web-based loan application to the auction system. Once the loan application information is verified (a function performed by the agency offering the auction service), the application is translated into an “anonymous” version, where the personal information of the borrower himself is replaced by “placeholders” known and controlled by the auction service. The “anonymized” version of the loan application is then posted on the auction's web site for bidding by potential lenders.

Owner:CAHN ROBERT

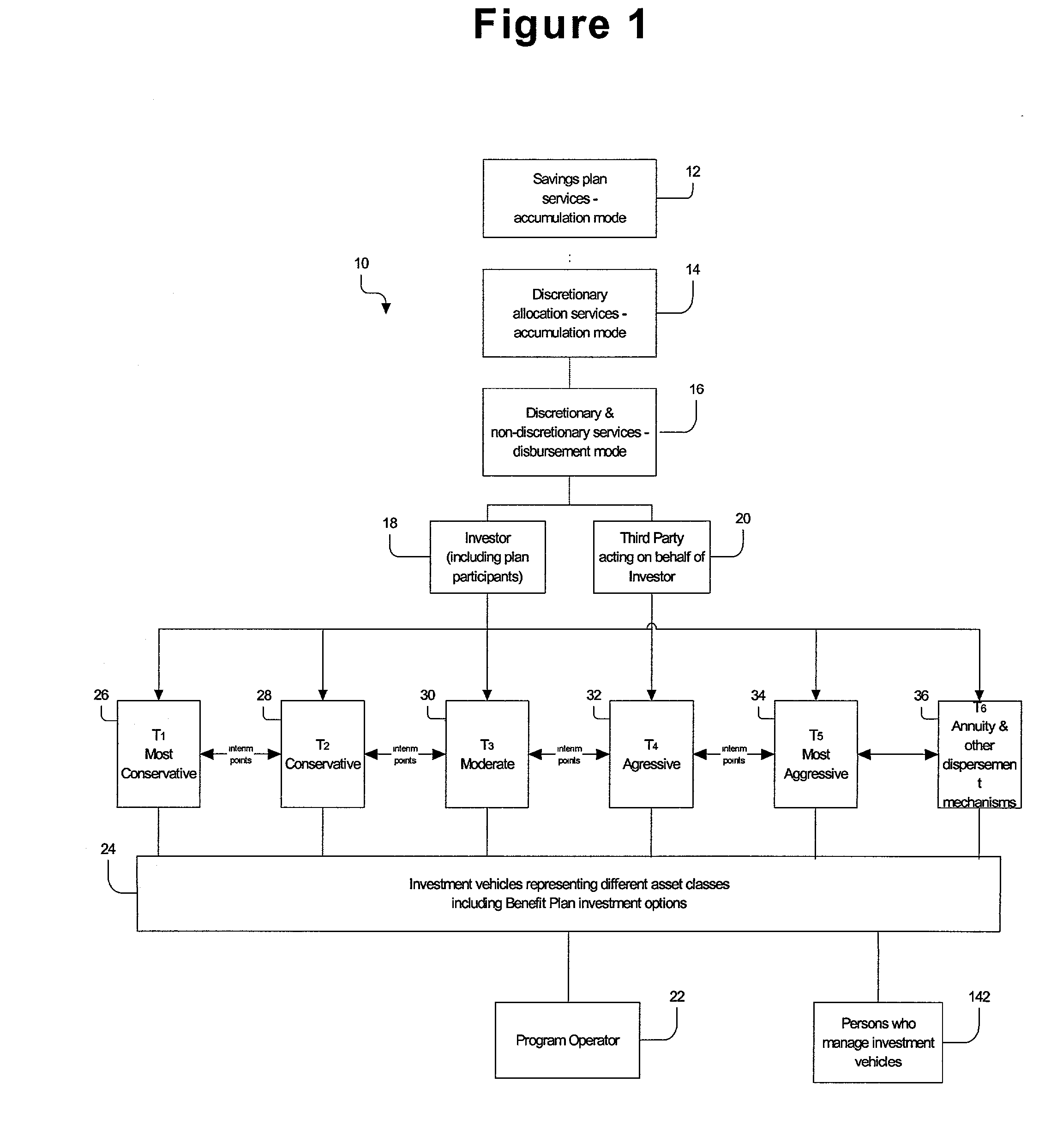

Systems and methods for improving investment performance

InactiveUS20020169701A1Eliminate orAmeliorate possible economic conflict of interestFinancePayment architectureIt investmentFinancial transaction

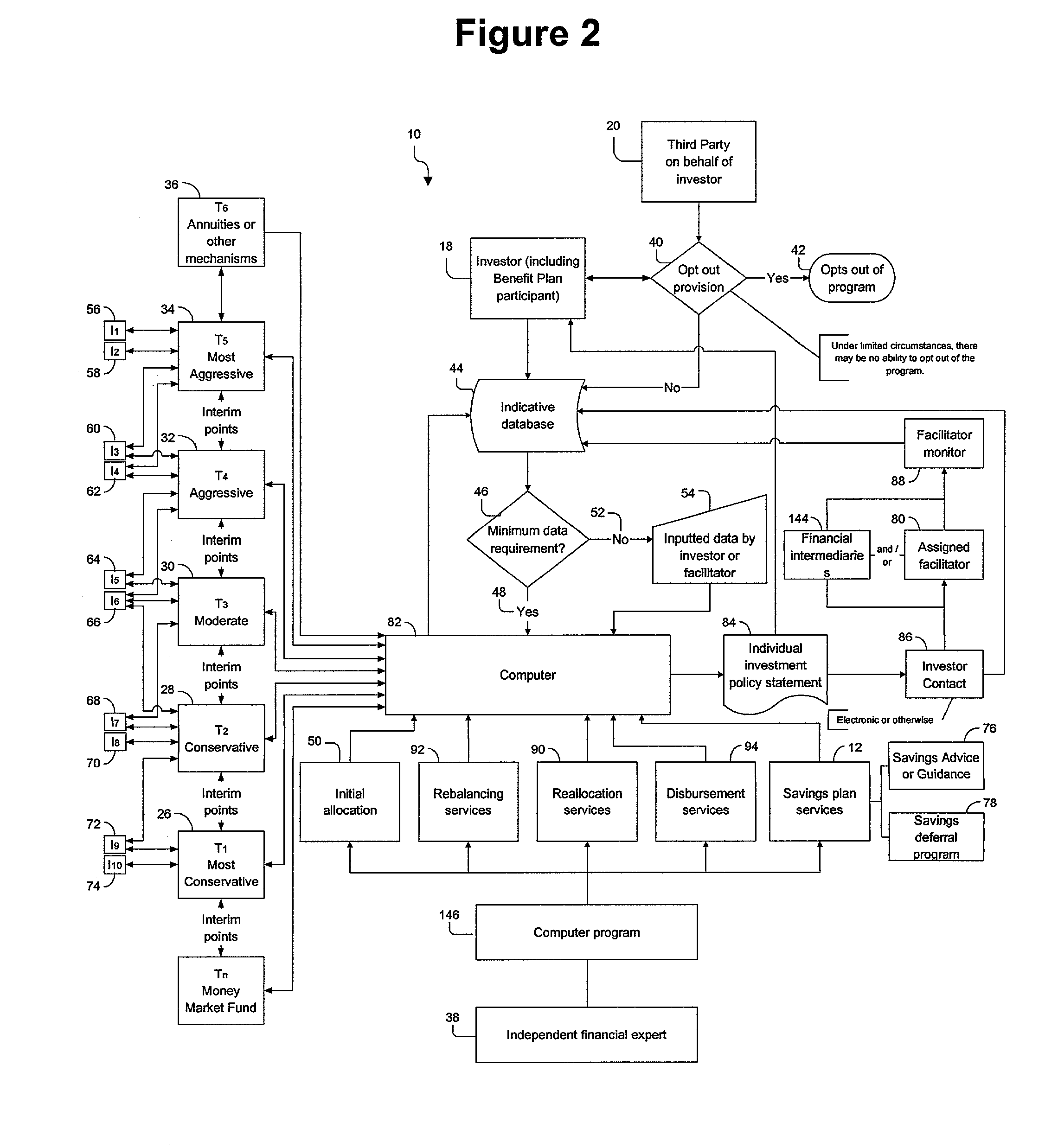

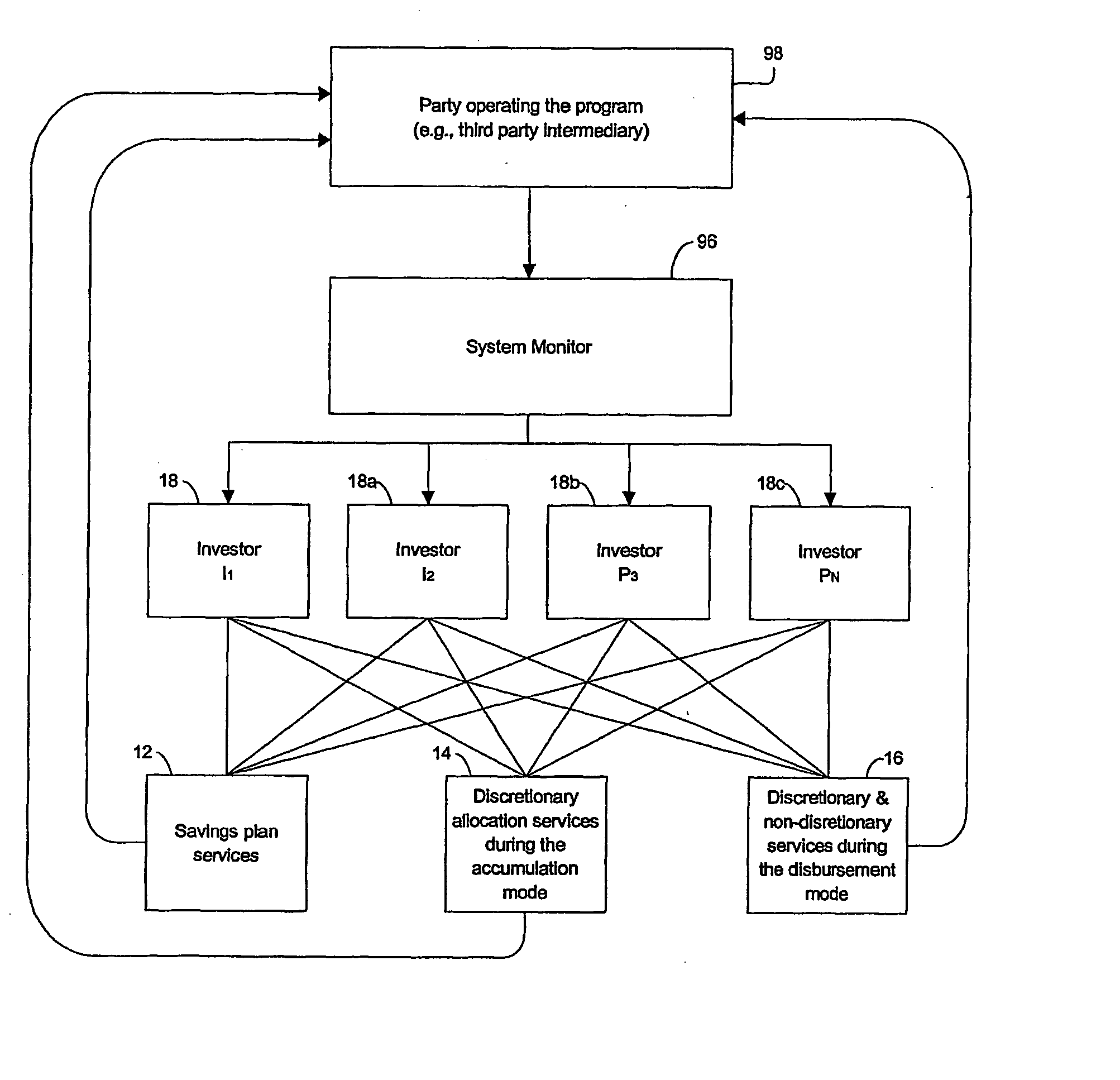

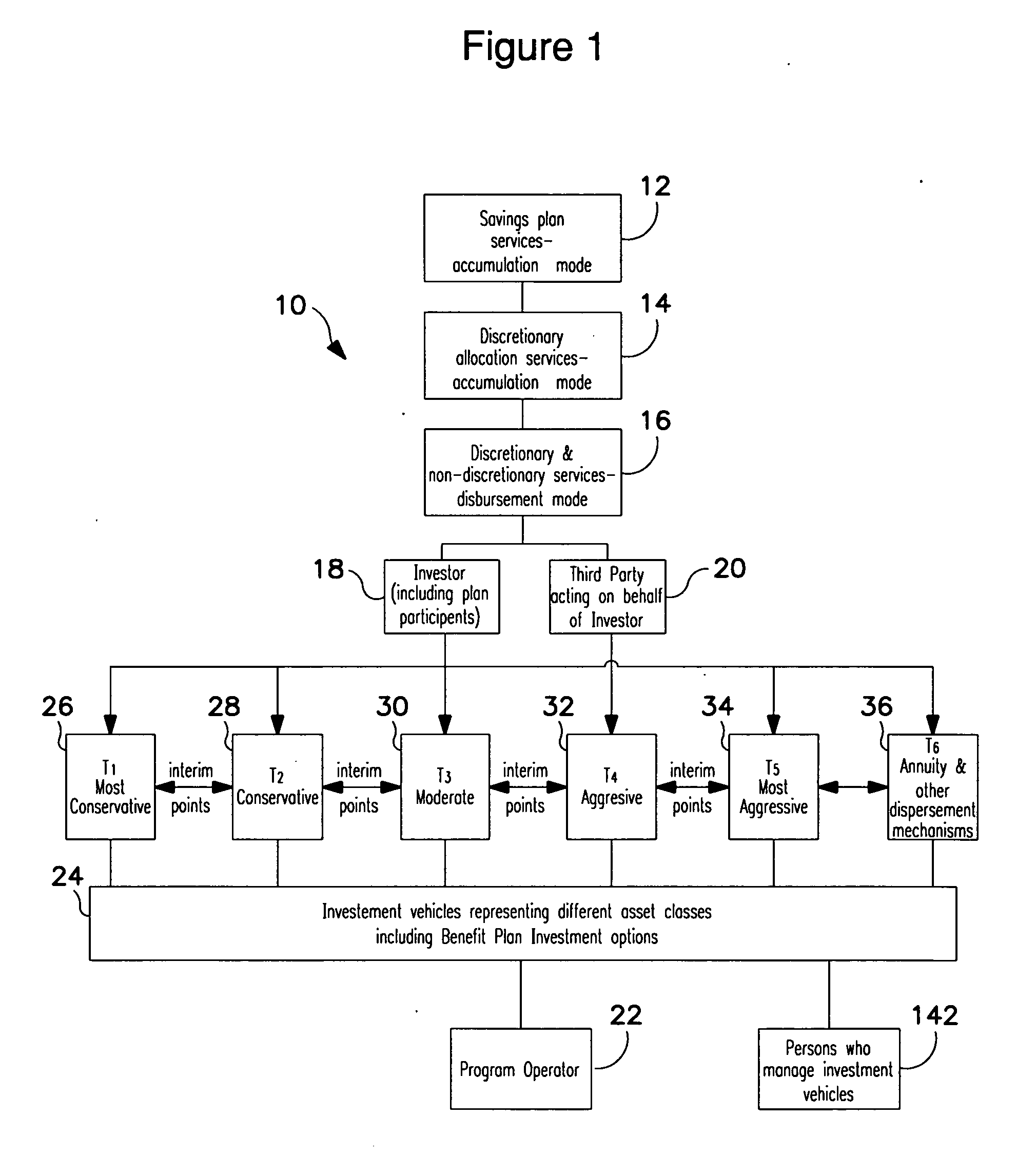

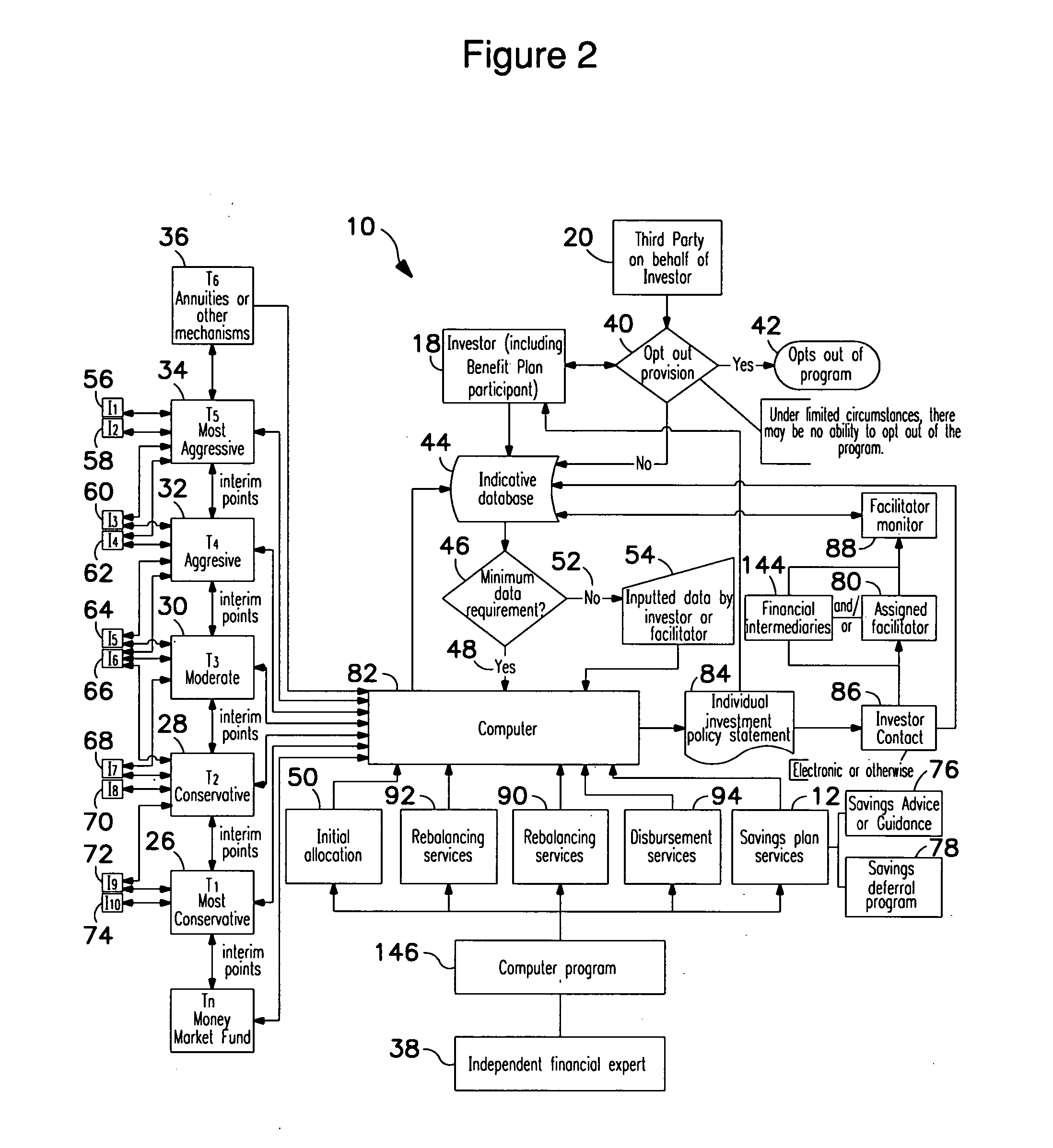

Systems and methods for a data processor implemented system monitor for enabling investors, or persons who act on their behalf, to simply turn over the allocation their investment assets, and / or turn over the determination of how much to save and / or to receive advice on how much to save and / or turn over the determination of how to receive disbursements from investments and / or to receive advice on how to receive disbursements from investments, in a manner that is free from or ameliorates the traditional conflicts of interest in previous systems is disclosed. The systems and methods are adapted to separate or otherwise ameliorate the tension between other functions where the compensation traditionally varies depending on the allocation or the amount saved or how funds are disbursed (e.g., money management, licensed securities brokerage). The systems and methods collect, monitor and direct information from the investors (including employee benefit plan accounts), persons who make decisions on behalf of investors, persons who hold indicative data (e.g., employers), money managers, persons who facilitate transactions and Independent Experts to provide professional asset allocation services (including automatic allocation, rebalancing, and reallocation of investment assets) on a regular basis; as well as assistance in determining how much to save or how to receive disbursements in a manner that eliminates or ameliorates conflicts of interest, which, in the case of employee benefit plans, is consistent with the regulatory restraints of ERISA.

Owner:TARBOX INTPROP LLC

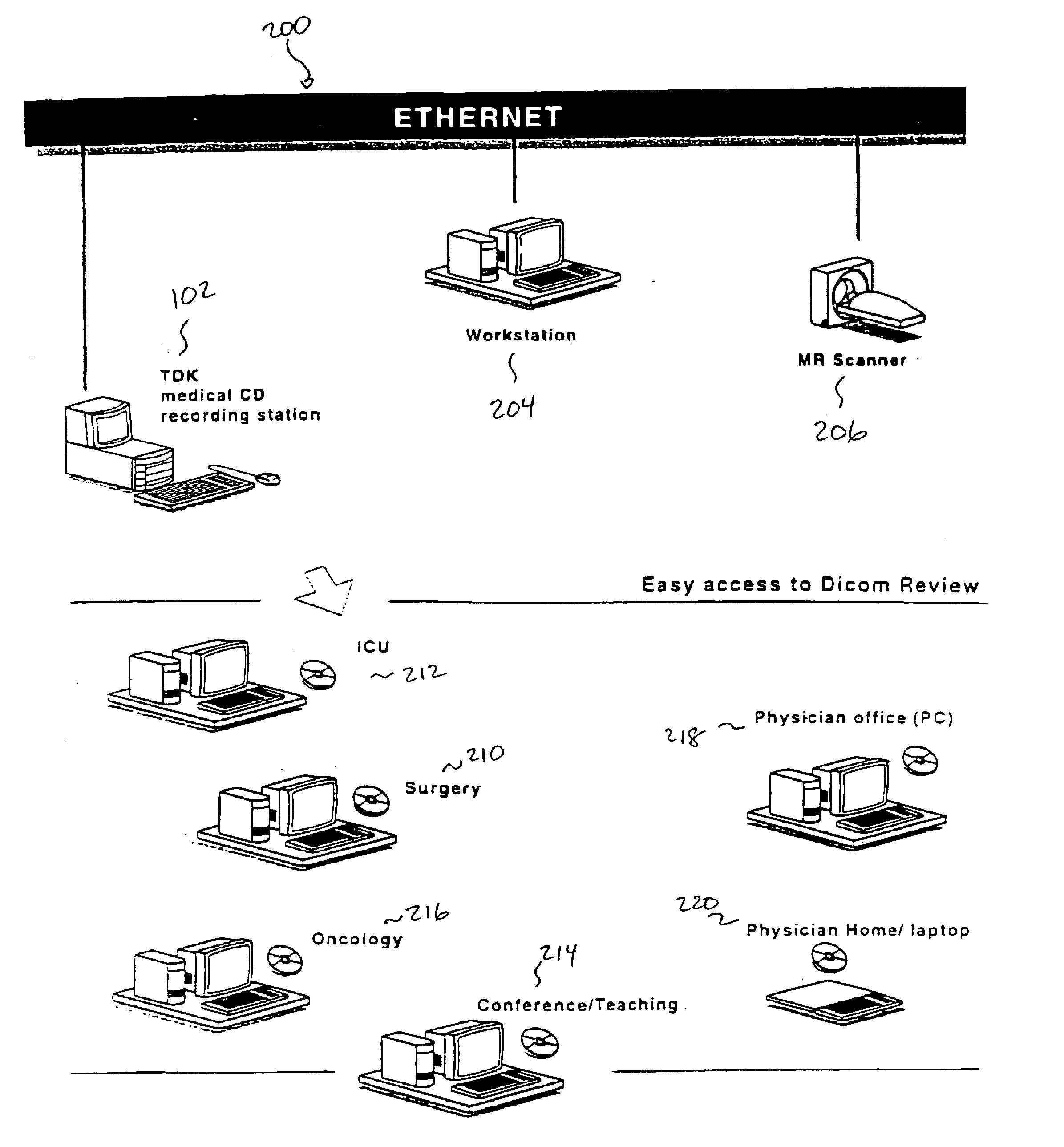

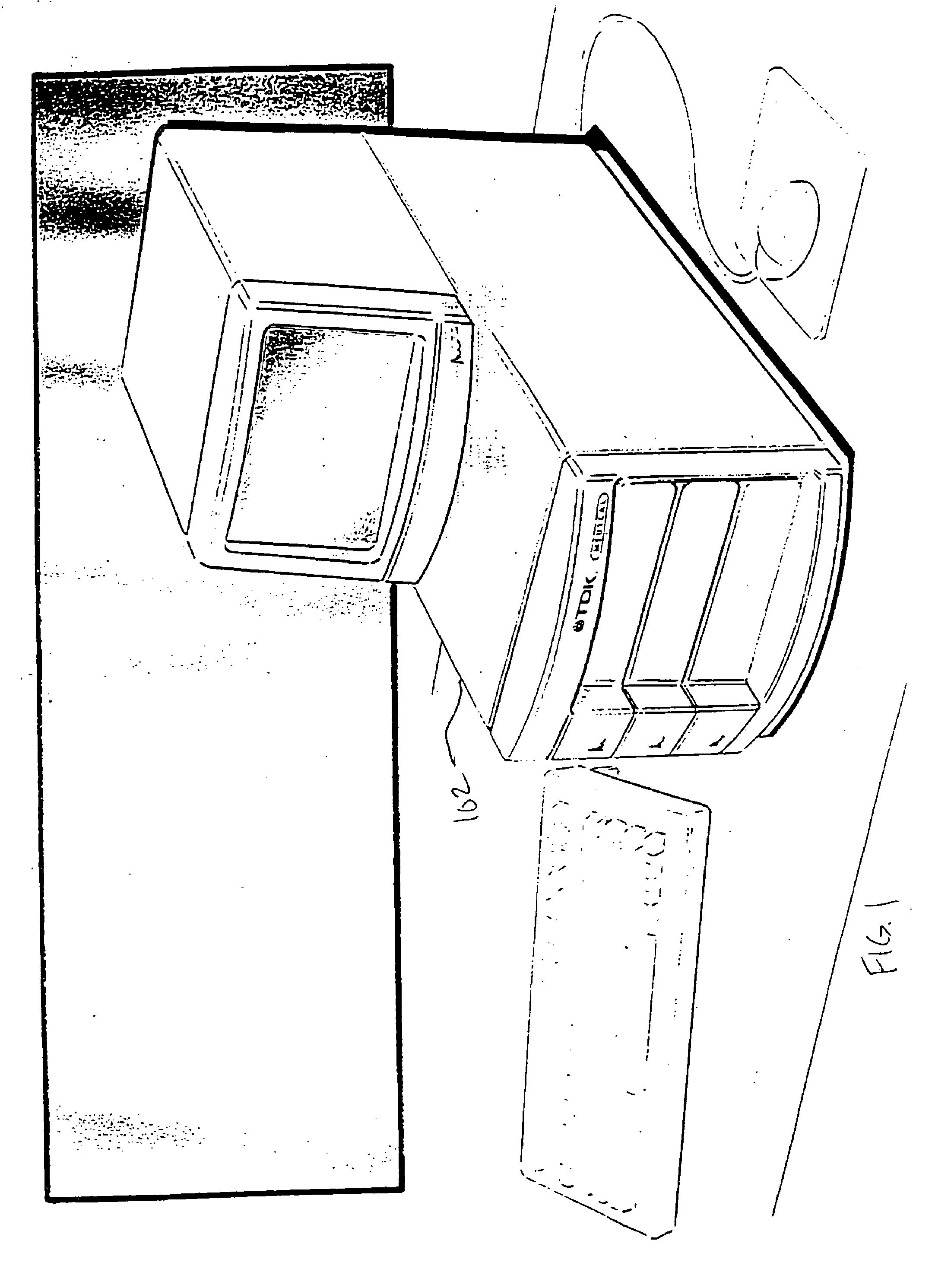

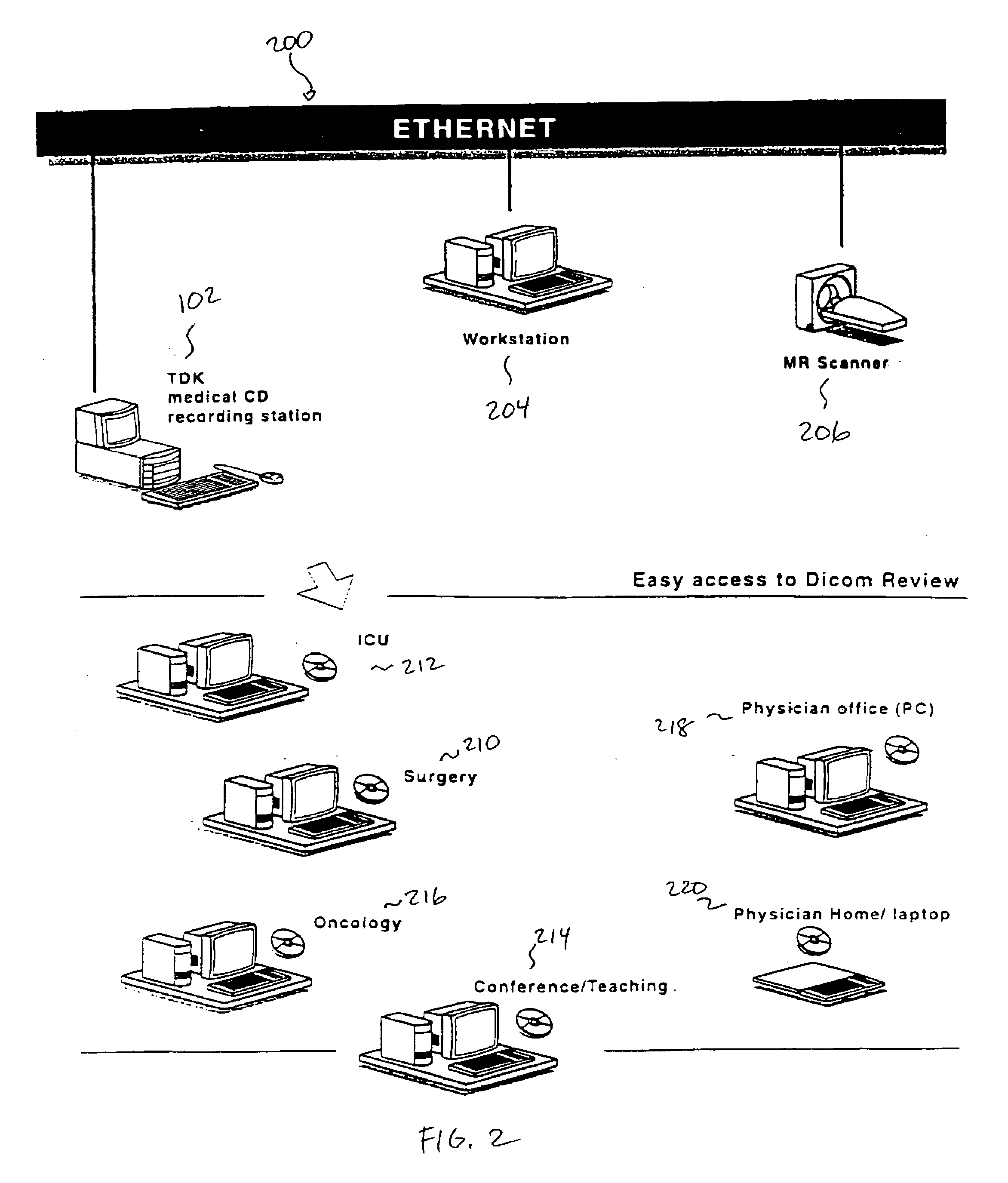

Removable media recording station for the medical industry

InactiveUS6954802B2Easy accessImprove distributionData processing applicationsCharacter and pattern recognitionIt investmentRemovable media

A removable medium recording station records medical image data in a format and removable medium that are widely accepted. The removable medium recording station can be used to effectively replace an installed storage device on an existing stand-alone medical image workstation. Storage onto removable media is transformed into an outboard operation. This transformation enables a hospital to migrate existing medical imaging systems to new formats and media without sacrificing a large portion of their initial investment. Additionally, the removable medium recording station can be attached as a peripheral on an existing medical modality network. In this capacity, the removable medium recording station enables an operator on the medical modality network to store medical images in a selected format and on a selected type of removable medium regardless of the proprietary format used by the enterprise level archive server. The removable medium recording station enables a hospital to add new functionality without sacrificing their investment in their enterprise solution.

Owner:TDK US CORP

Financial modeling and counseling system

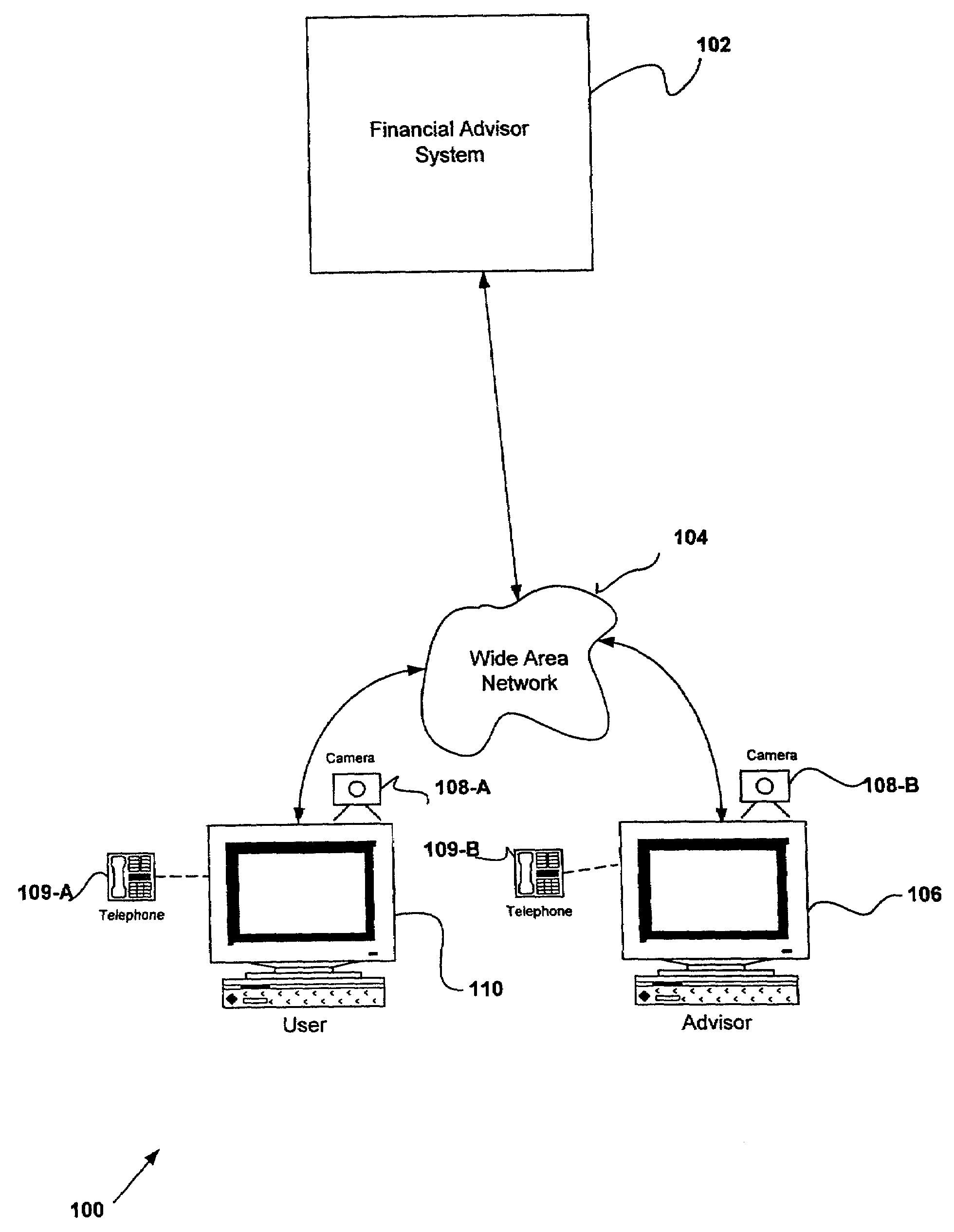

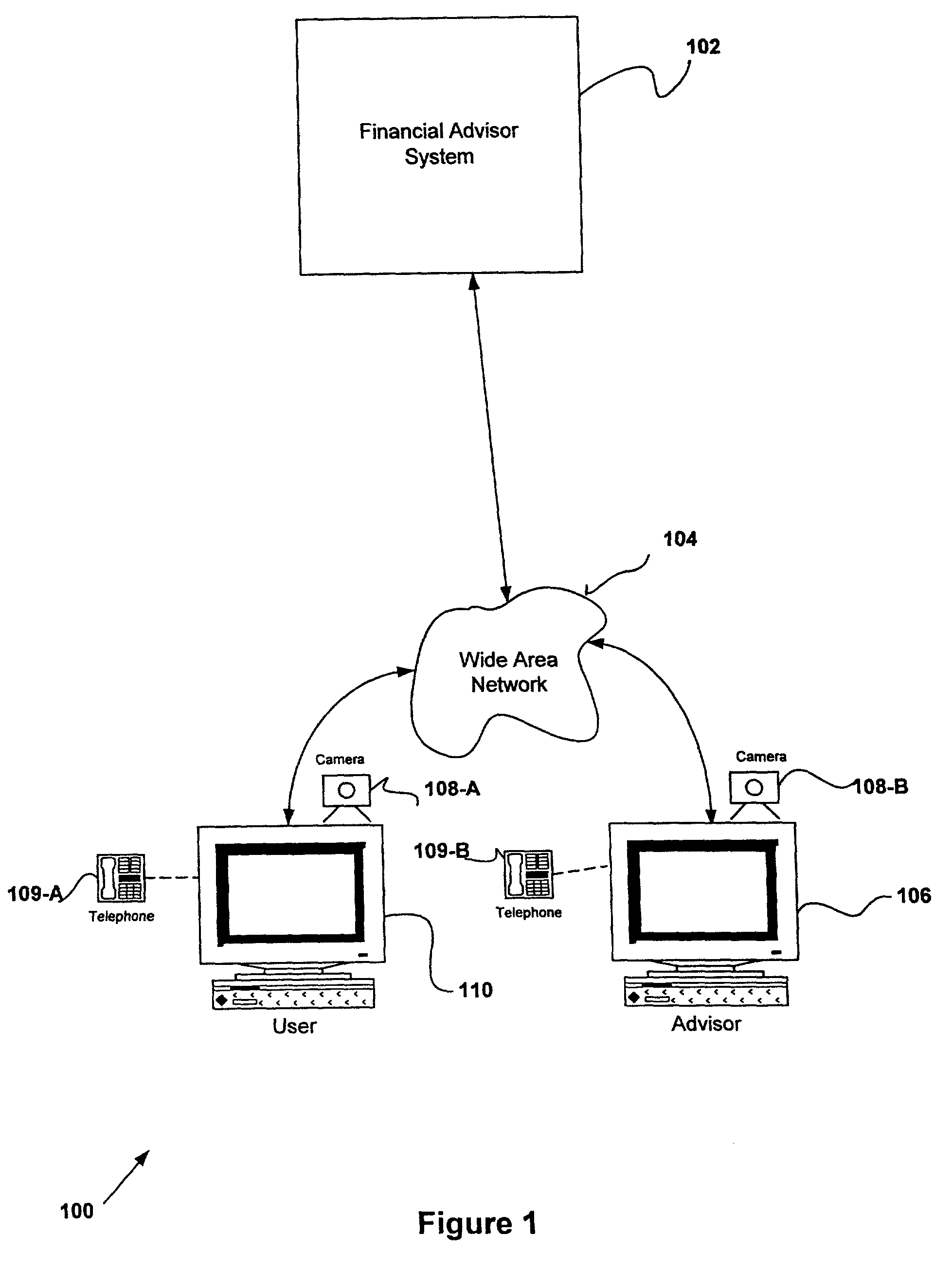

The present invention relates to a web-based financial management system for providing personalized financial coaching to a user. The system operates in a collaborative computing environment between the user and a financial advisor and comprises a service level subsystem and an advice generating subsystem. The service level subsystem allows the user to negotiate a service level agreement that defines the user's desired level of support and limits access to user provided information. The advice generating subsystem is coupled to the service level subsystem and includes one or more coaching engines that dynamically analyze the financial needs of the user in accordance with the user's service level agreement. Furthermore, the coaching engine provides customized financial advice tailored to the user's life intentions. The present invention also provides for a financial portfolio management subsystem enabling the user to model the effects of adding or deleting various securities and helping the user to better conform his portfolio to his level of risk tolerance and his investment style.

Owner:ACCENTURE GLOBAL SERVICES LTD

System for Transmitting Syndicated Programs over the Internet

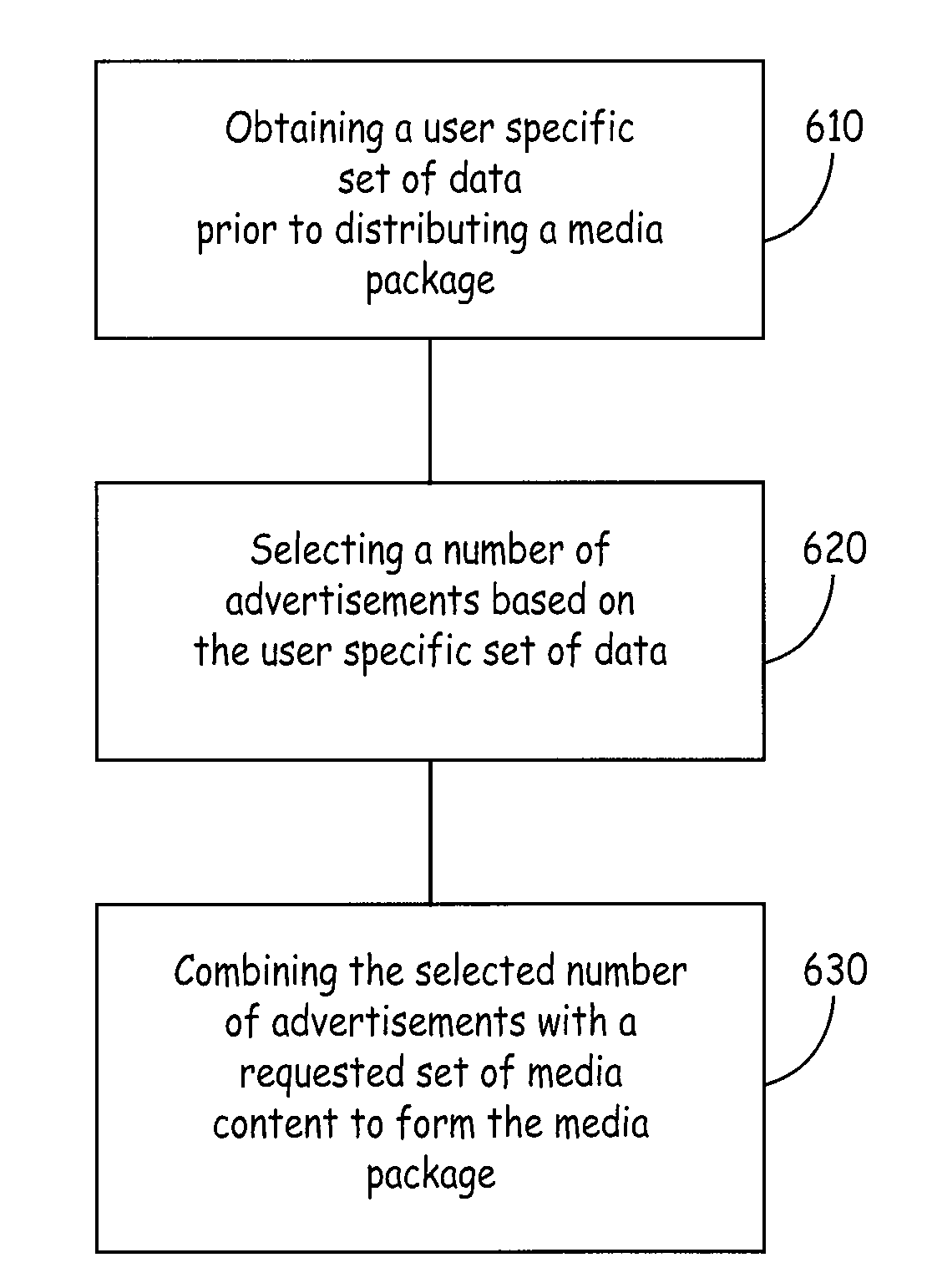

ActiveUS20080319828A1Protect interestsPreserve its investmentResourcesSelective content distributionIt investmentData set

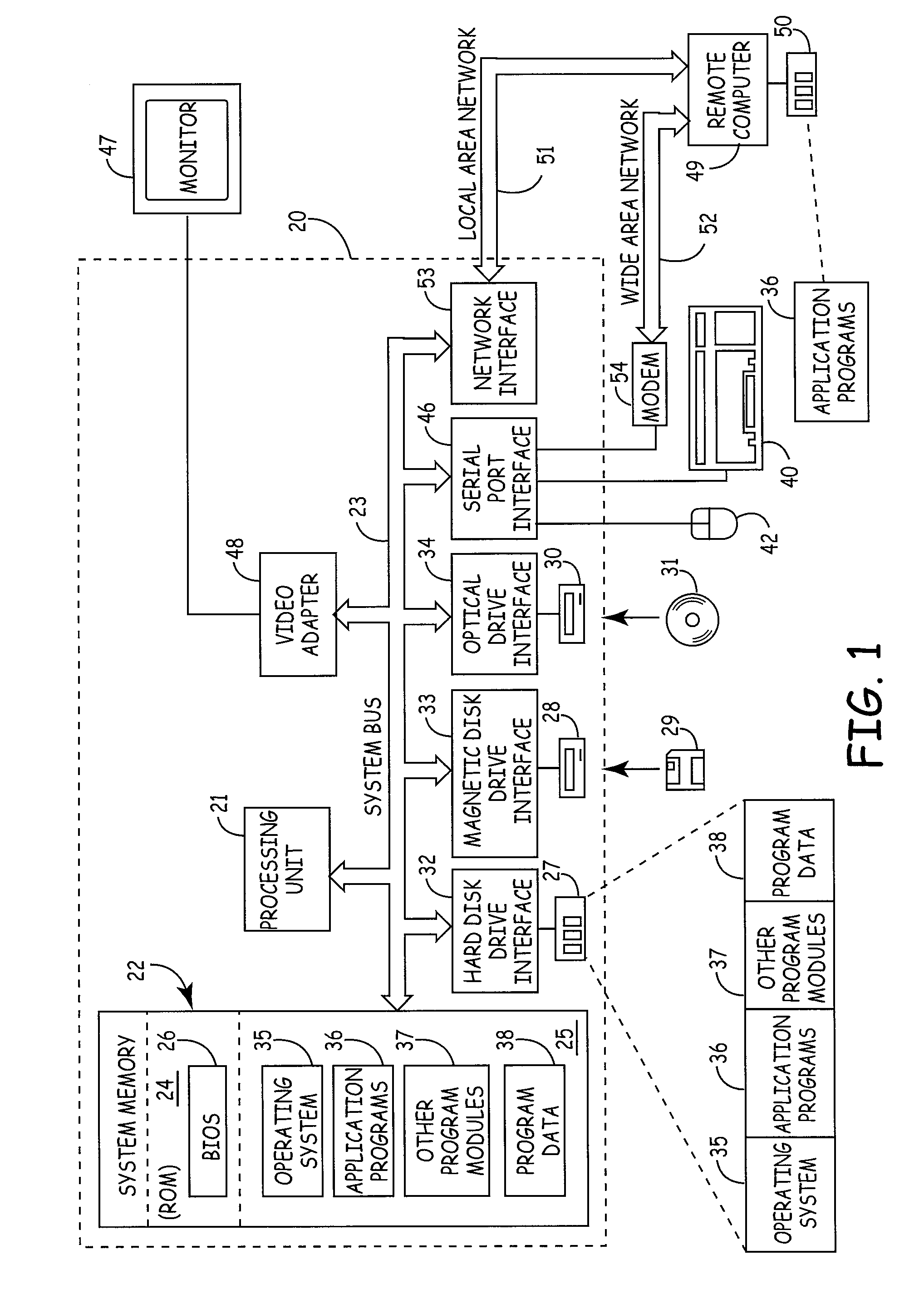

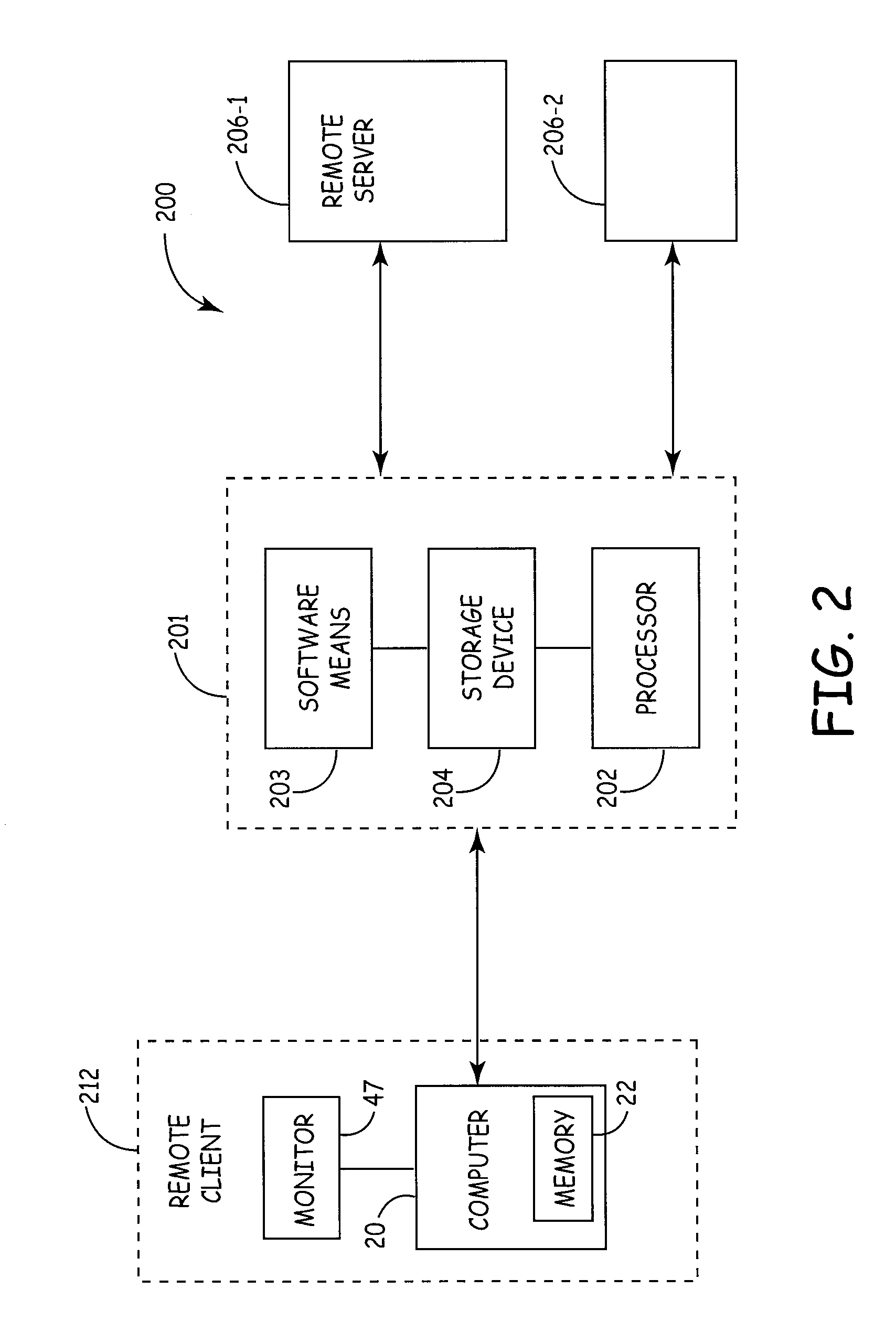

A system and method are provided for exposing Internet users to advertisements together with the distribution of media content in a manner which is germane to conventional syndicated broadcast agreements. The system includes a processor coupled to a memory device. The system further includes software means operable on the processor and memory device. The software means is operable on the processor for obtaining a user specific set of data prior to distributing a media package. The software means is operable for selecting a number of advertisements from a data bank containing a plurality of advertisements based on the user specific set of data. The software means is operable for combining the selected number of advertisements with a requested set of media content to form the media package. The software means is further operable for distributing the media package. In this manner a regional broadcasting station can preserve its investment in purchasing national syndicate broadcast rights by ensuring regional advertisers a penetration of their advertisements across a regional Internet audience. Methods for performing the same are similarly included.

Owner:SYNDICAST CORP

Communication network based system and method for auctioning shares on an investment product

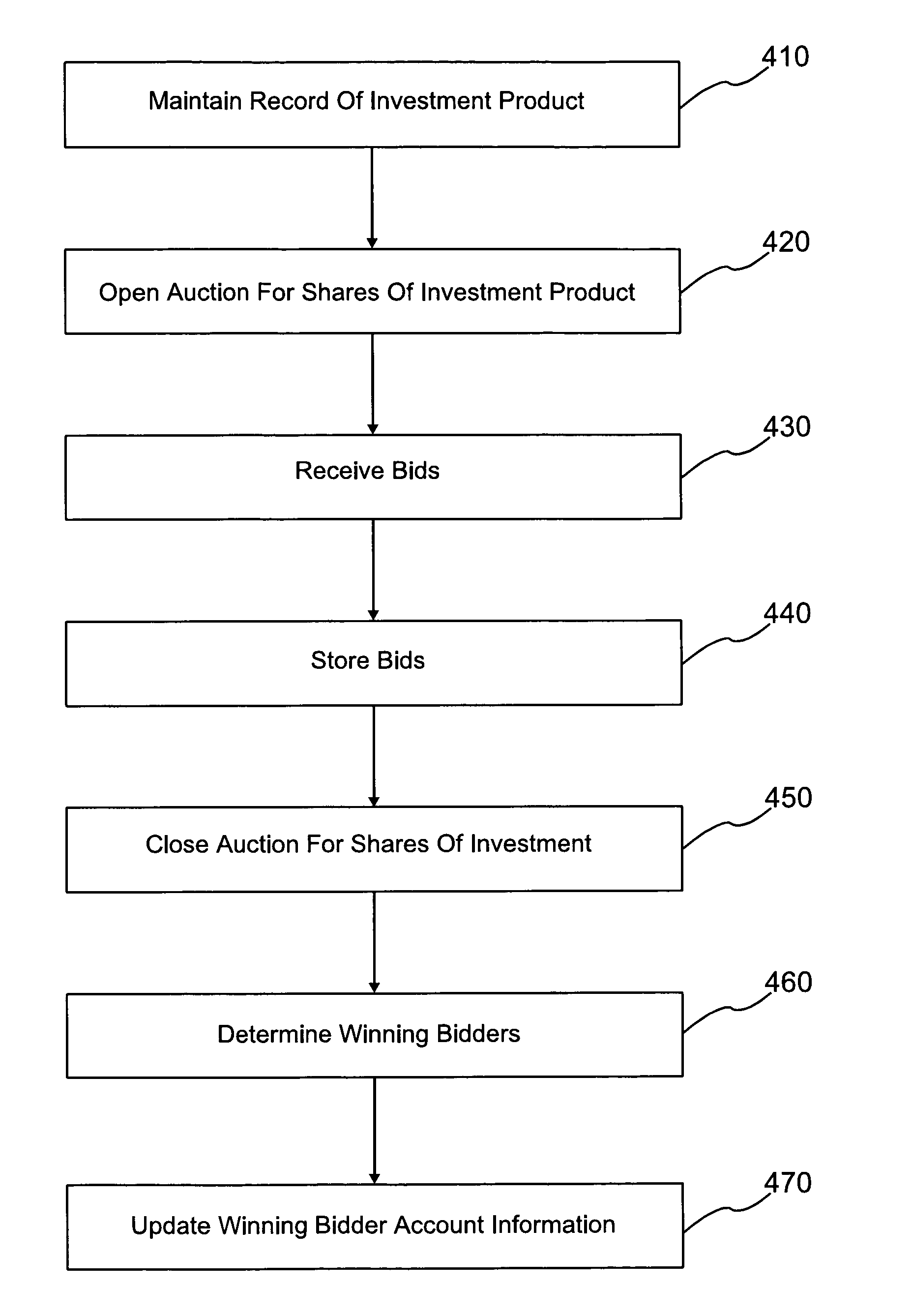

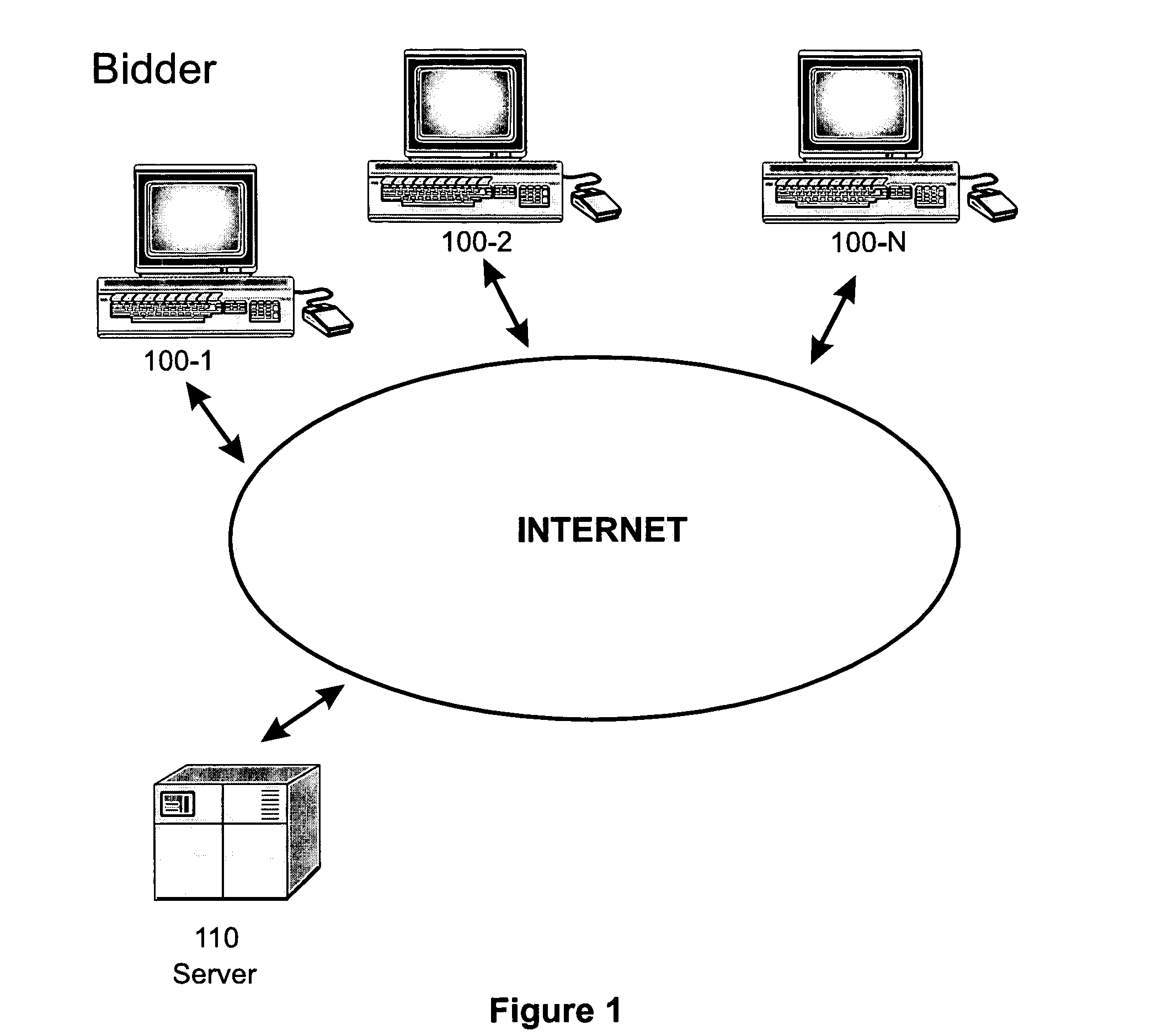

A communication network based system and method for auctioning shares of investment product is disclosed. In the preferred embodiment, an investment company pursuant to the Investment Company Act of 1940, creates a publicly registered investment product (e.g., a mutual fund) with its own capital and as sole shareholder. After the investment product returns a pre-determined hurdle rate, or rate of return, the investment company then preferably liquidates its investment position in the investment product in order to freeze the net asset value of the shares of the mutual fund. The investment product is later opened for auction and the server system receives and stores bids from a plurality of bidders, in increments up to the net asset value. The bids preferably comprise a bid price per share and the number of shares bid. At the close of the auction, the server system preferably determines winning bidders by successively determining the highest bidder. During this process, the server system reduces the total number of available shares to be distributed by the number of shares bid by the highest bidder. Once all of the available shares have been allocated to the winning bidders, the investment product shares are redeemed at the net asset value reflecting the hurdle rate. Each of the winning bidders is receives a return equal to the difference between the net asset value and the respective winning bidders' bid price per share multiplied by the number of shares bid by each respective winning bidder.

Owner:PODSIADLO EUGENE LAWRENCE

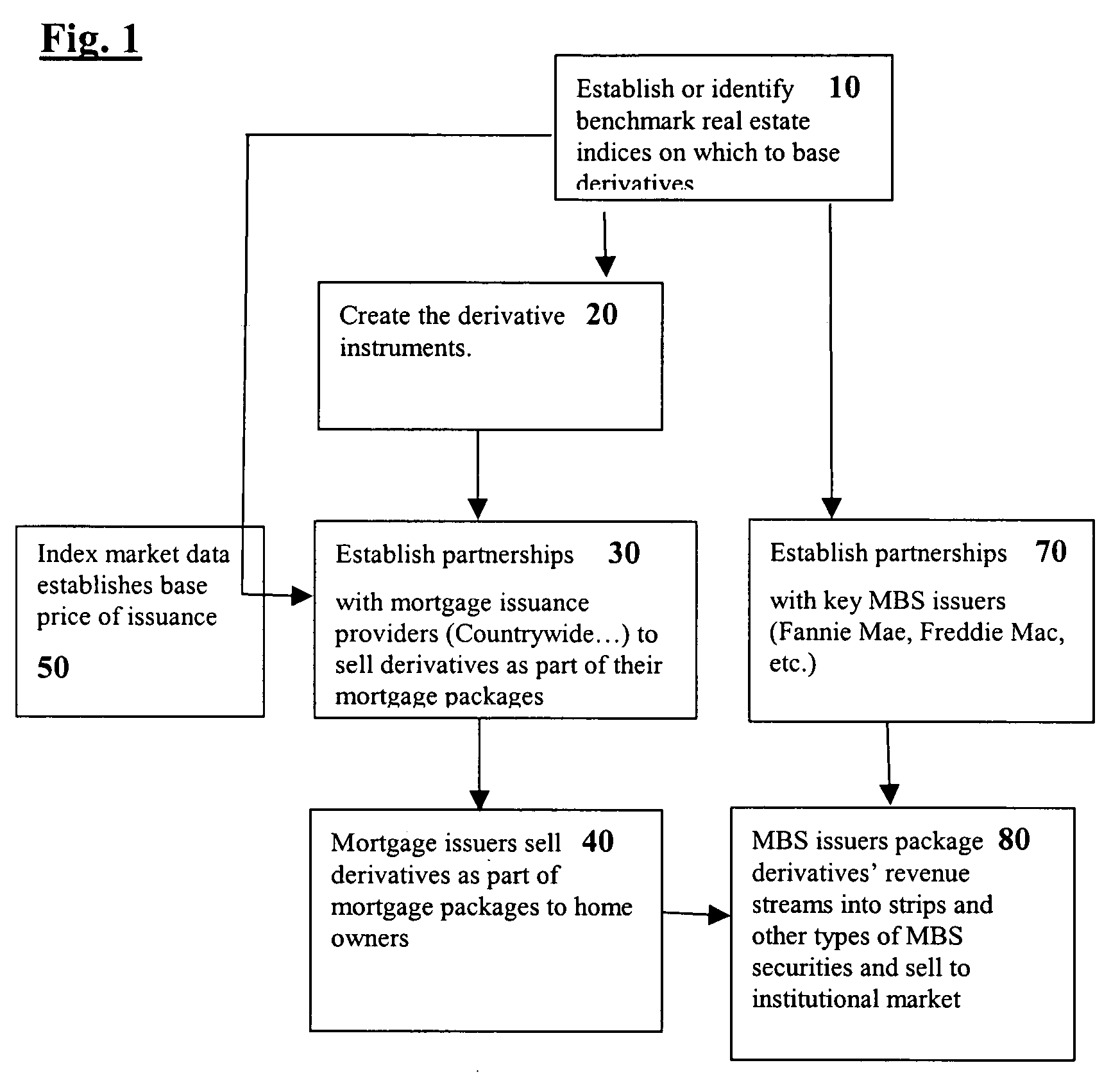

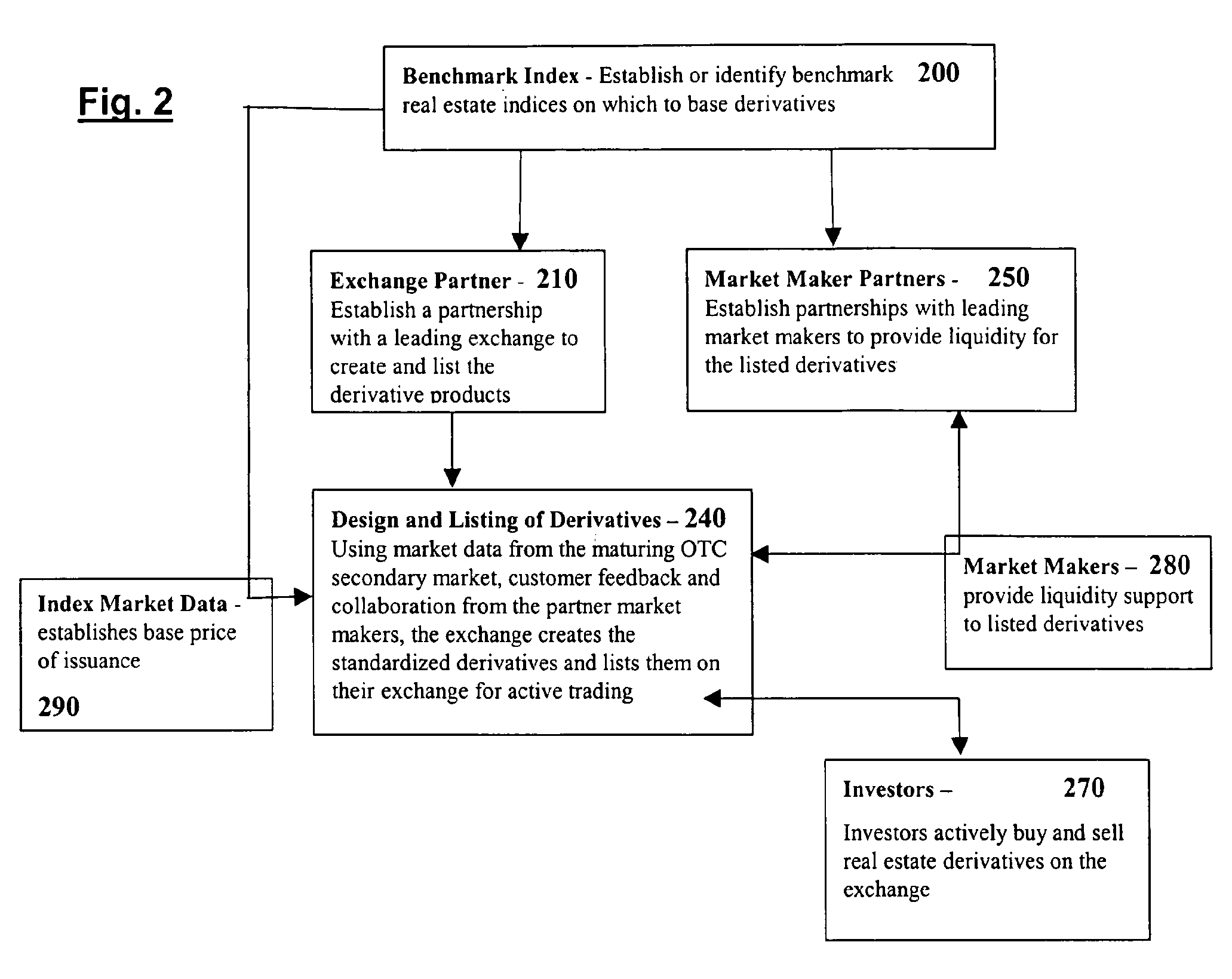

Home equity protection contracts and method for trading them

A method for creating, marketing, and selling a contractual instrument for protecting a value characteristic of a homeowner's residential real estate property is provided according to the invention. The derivative instrument can be created in the form of a simple contract like a “Home Equity Protection Product” sold to the homeowner by a mortgage originator or P&C insurer. It provides a cash-settled payout to the buyer at a predetermined expiration date defined by the contract correlated to, e.g., the home's market value or home equity value, and a reduction in value of a benchmark real estate index between, e.g., the contract purchase date and the expiration date. The Home Equity Protection Contracts of the present invention may be securitized much like mortgage-backed securities on a secondary and sold to institutional investors to permit them to speculate in the value of residential real estate in order to broaden their investment portfolios.

Owner:DRI

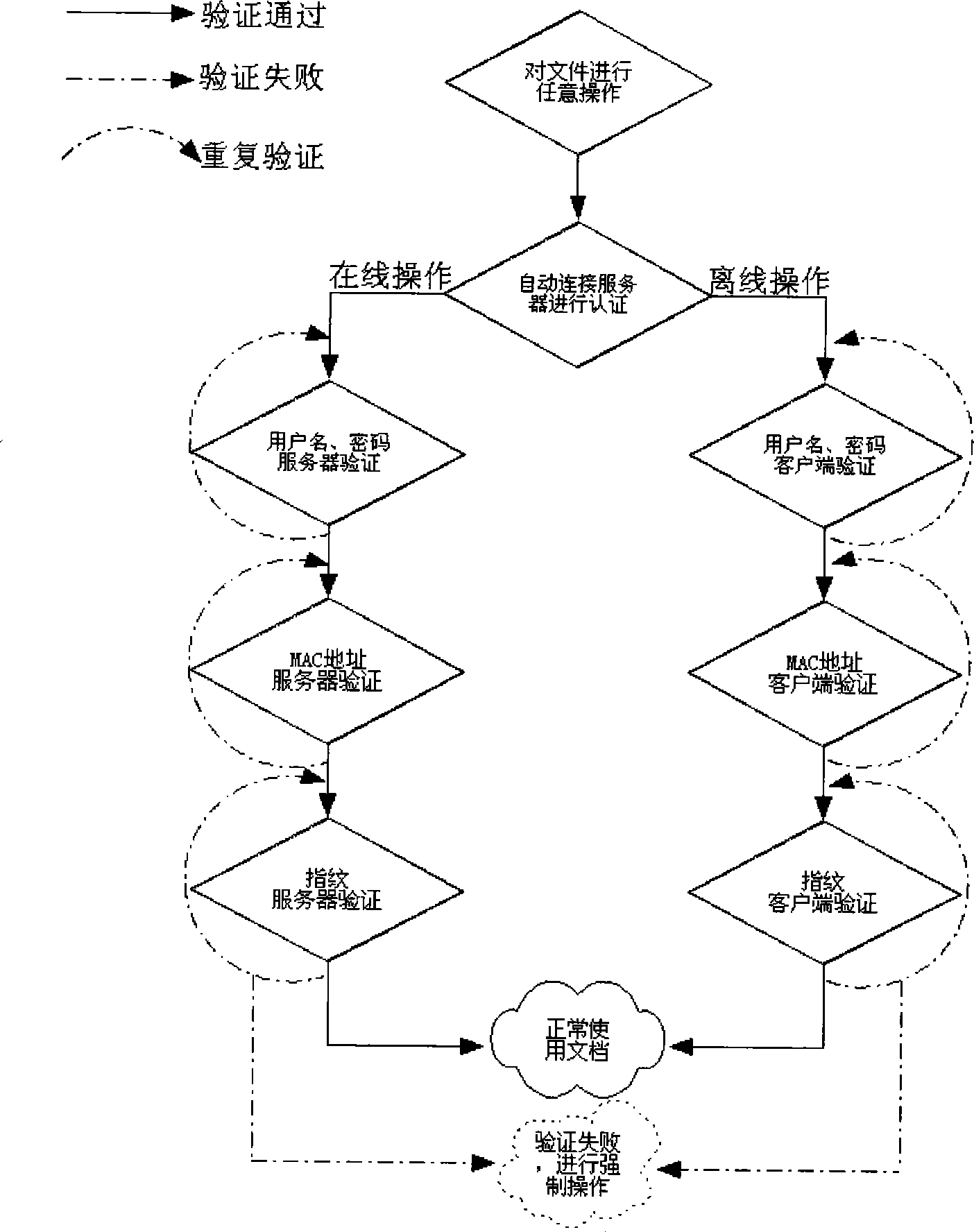

Method for guarantee safety of electronic file

InactiveCN101364984AImprove protectionLow costUser identity/authority verificationDigital data authenticationElectronic documentIt investment

The invention relates to a method for ensuring the safety of an electronic file, which comprises an encryption process and a decryption process. The passive protection technology is embedded on the basis of active encryption, so that the control of tissues to the electronic file can be kept outside a fire wall; the use strategy of the file is managed in a dynamic manner to extend the value of prior IT investment to the outer part of safety control and content management system, thereby reducing the cost of sharing information among customers, supplier, cooperative partners and other relevant parties.

Owner:XIAN DINGLAN COMM TECH

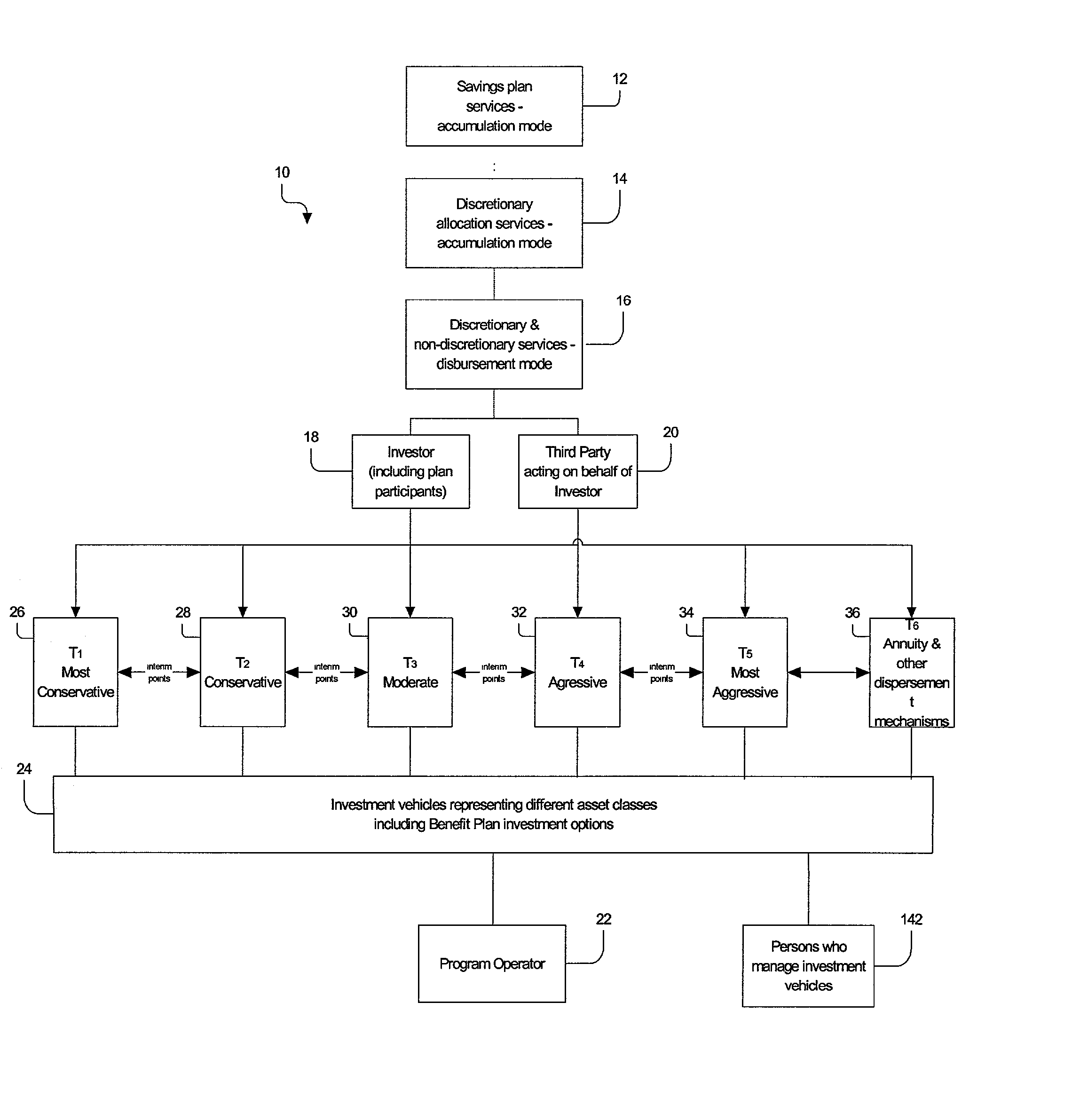

Systems and method for improving investment performance

InactiveUS20060080199A1Eliminate orAmeliorate possible economic conflict of interestFinancePayment architectureProgram planningEngineering

Methods for a data processor implemented system monitor for enabling persons to turn over the allocation of their investment assets, and / or receive assistance concerning how to receive disbursements from investments, in a manner that is free from or ameliorates the traditional conflicts of interest in previous systems. The systems and methods are adapted to ameliorate the tension between other functions where the compensation may be affected by asset allocation. The systems and methods collect, monitor, and direct information from persons who hold indicative data, e.g., employers, to provide professional asset allocation services, including automatic allocation, rebalancing, and reallocation of investment assets, on a regular basis; as well as assistance in determining how much to save or how to receive disbursements in a manner that ameliorates conflicts of interest, which, in the case of employee benefit plans, is consistent with the regulatory restraints of ERISA.

Owner:TARBOX INTPROP LLC

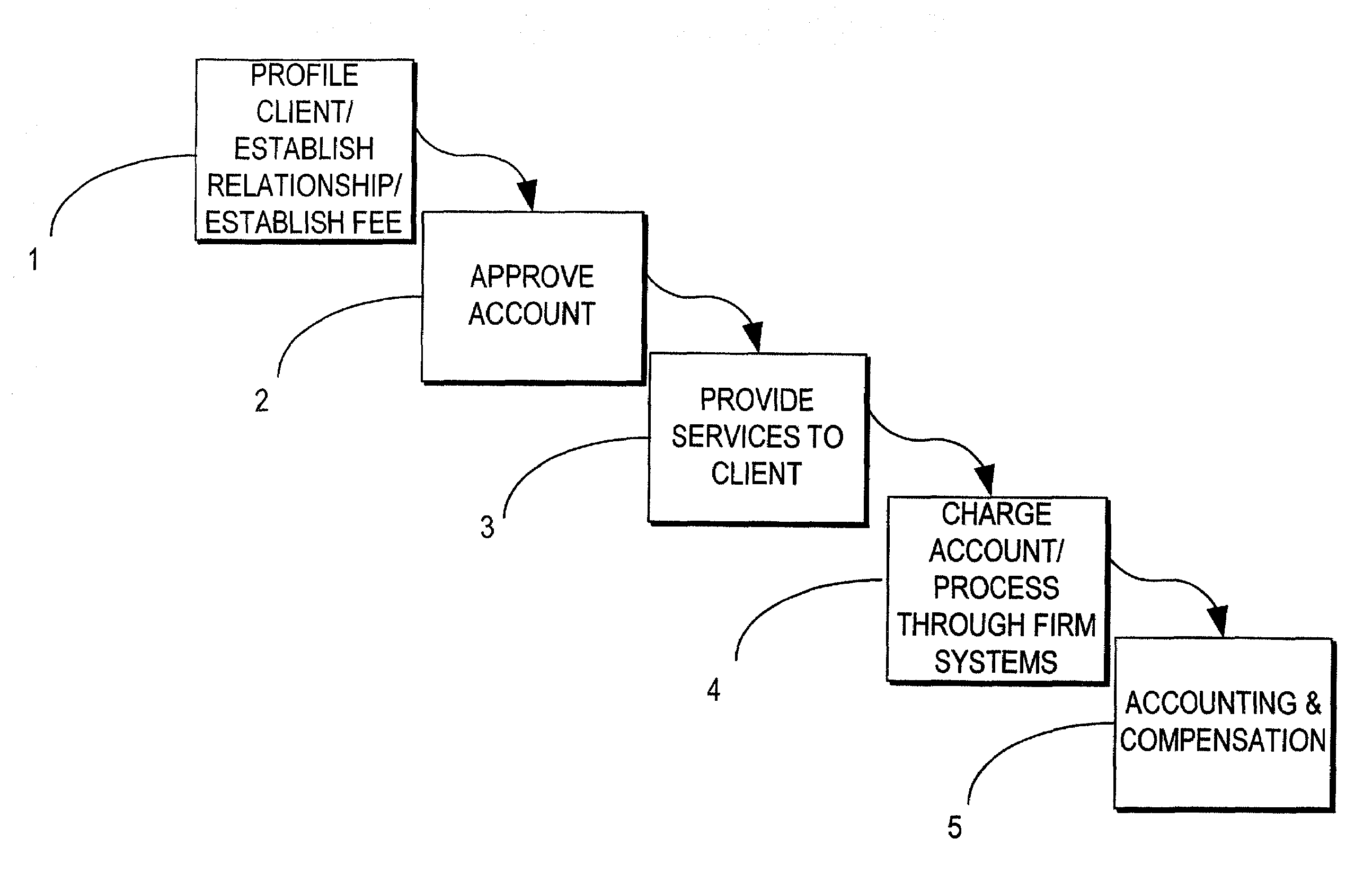

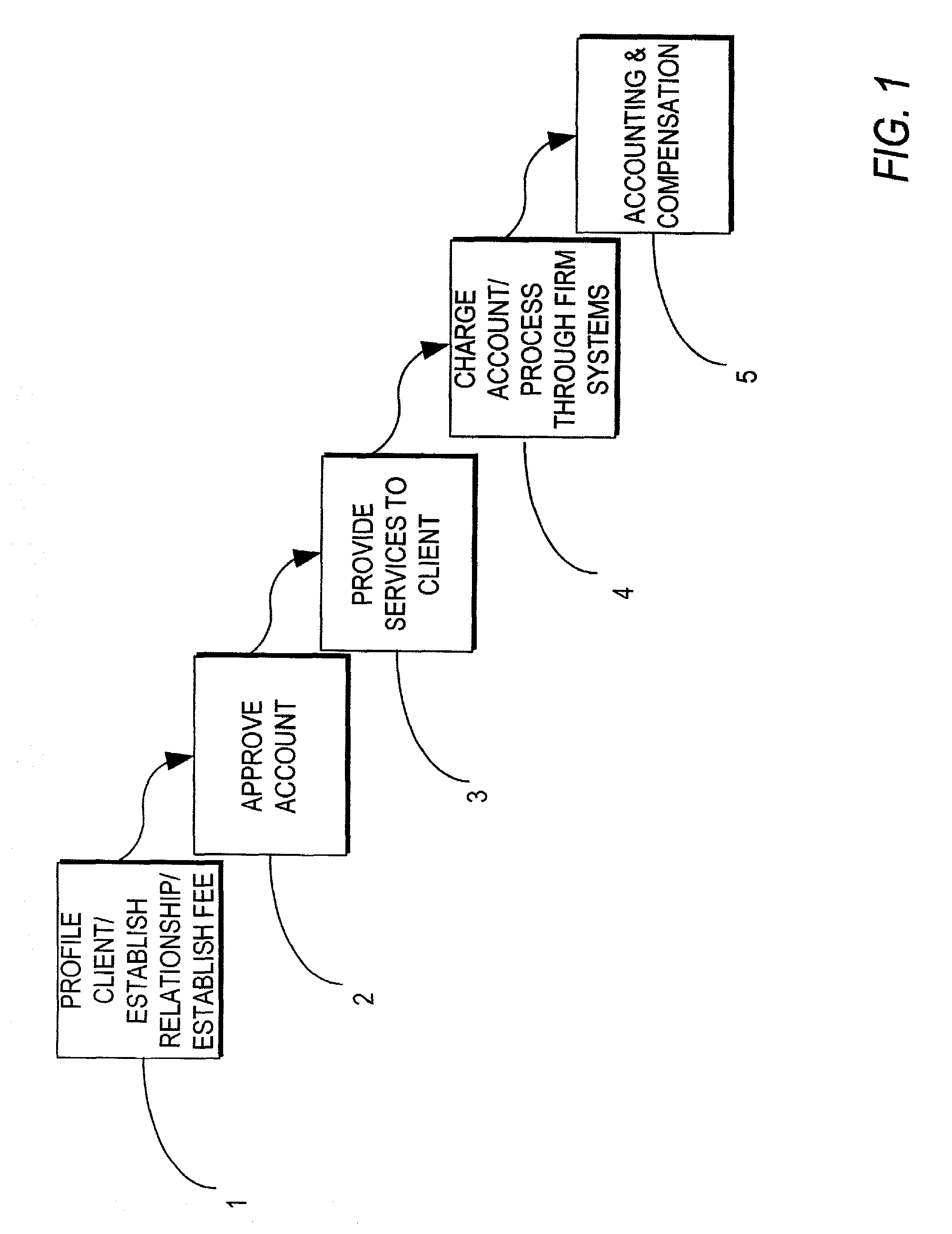

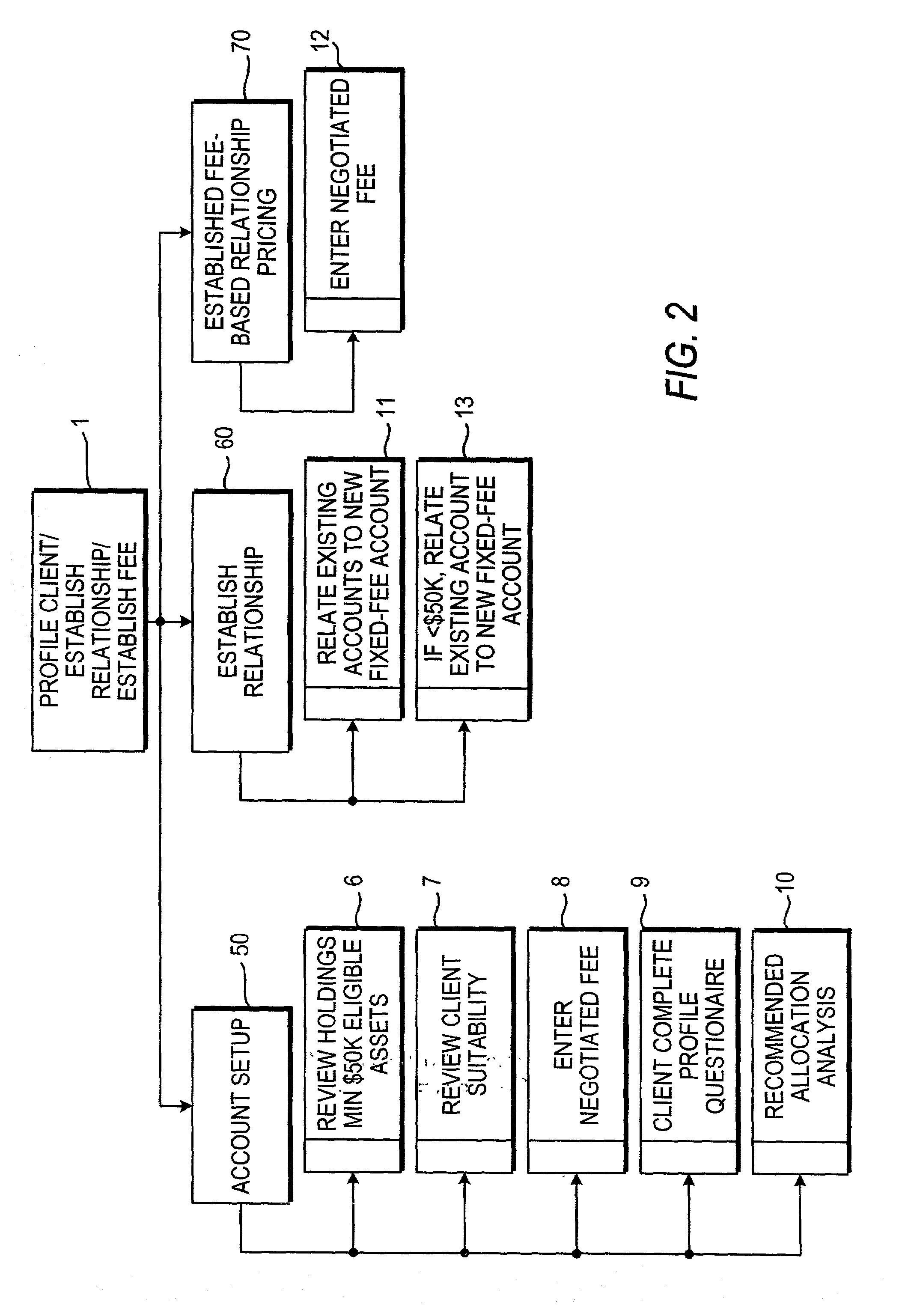

Systems, apparatus and methods for establishing a flat fee brokerage account system

A method including establishing a commission-free fee-based brokerage account for a client and maintaining a balance between the account's fee, its investment activity and services received, and compensation to a financial advisor of the client. Customized flat fee pricing can be calculated based on investment objectives, risk tolerances, asset mix, asset size, expected trading patterns, utilization of other firm services and the client account relationship (the existence of other accounts of that client with the firm). Systems calculate and recommend a fee to the financial advisor, who then negotiates with the client and determines a final fee. This dynamic pricing process includes a compensation adjustment to the financial advisor under certain pricing and trading scenarios.

Owner:UBS BUSINESS SOLUTIONS AG

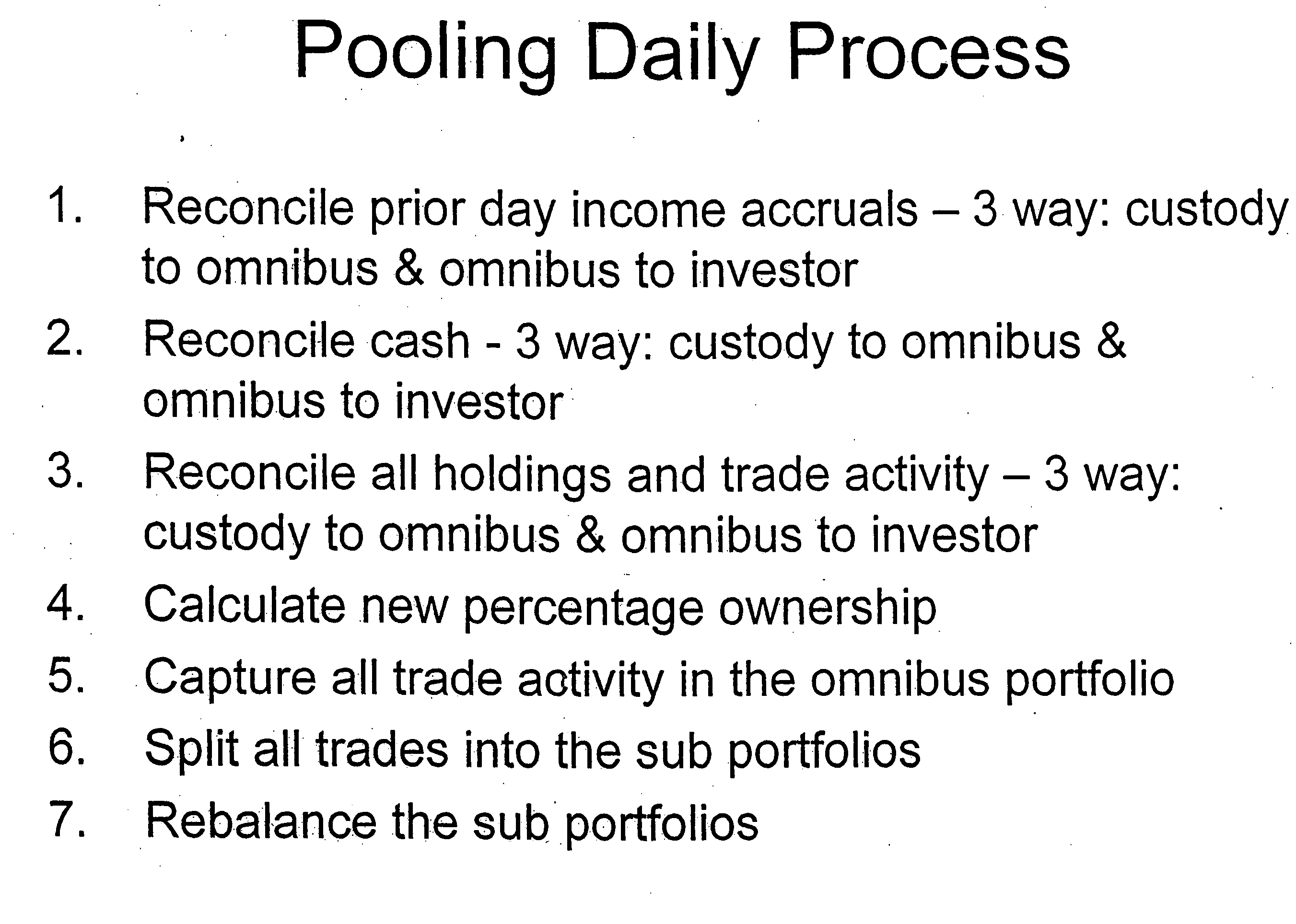

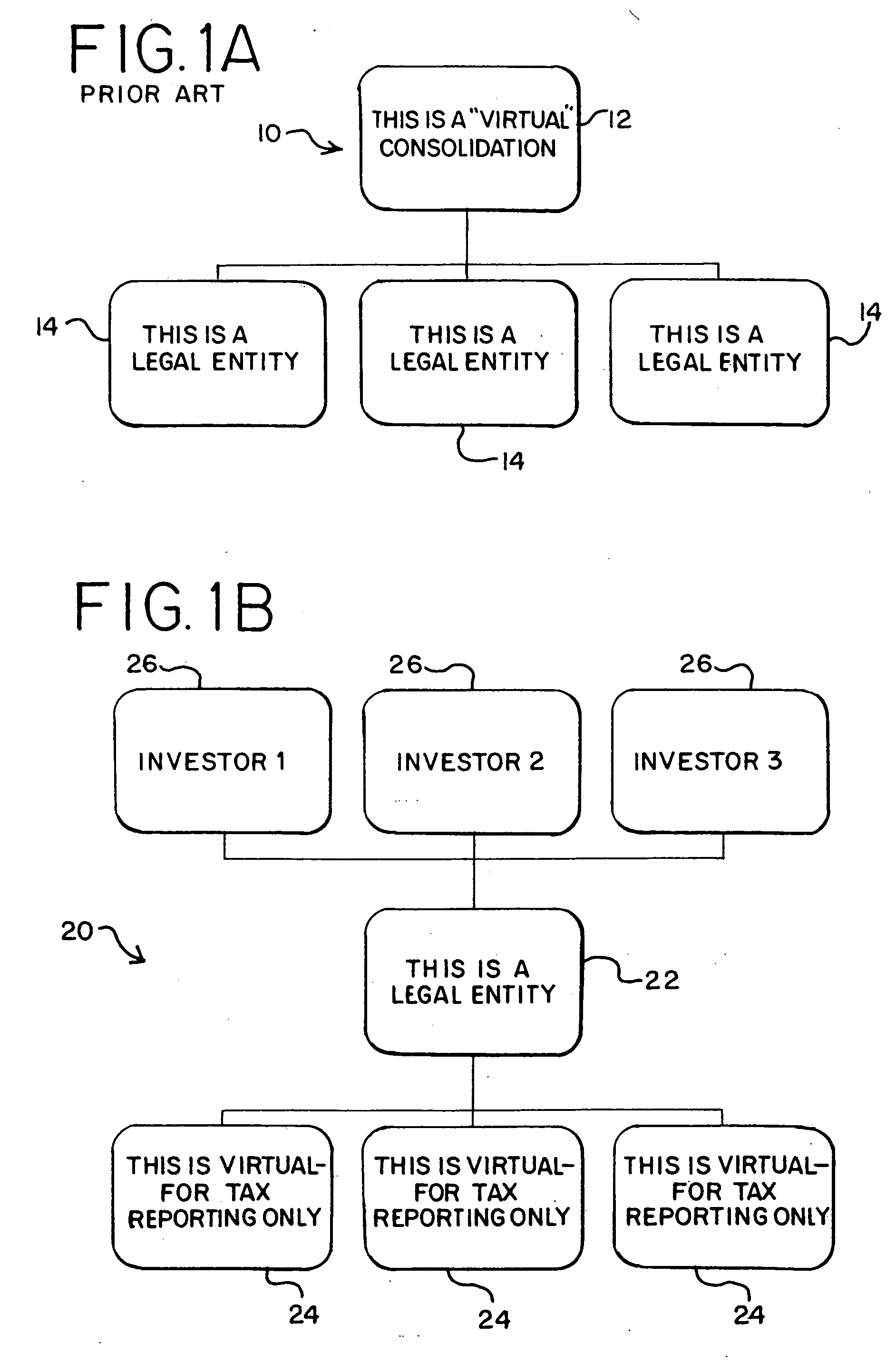

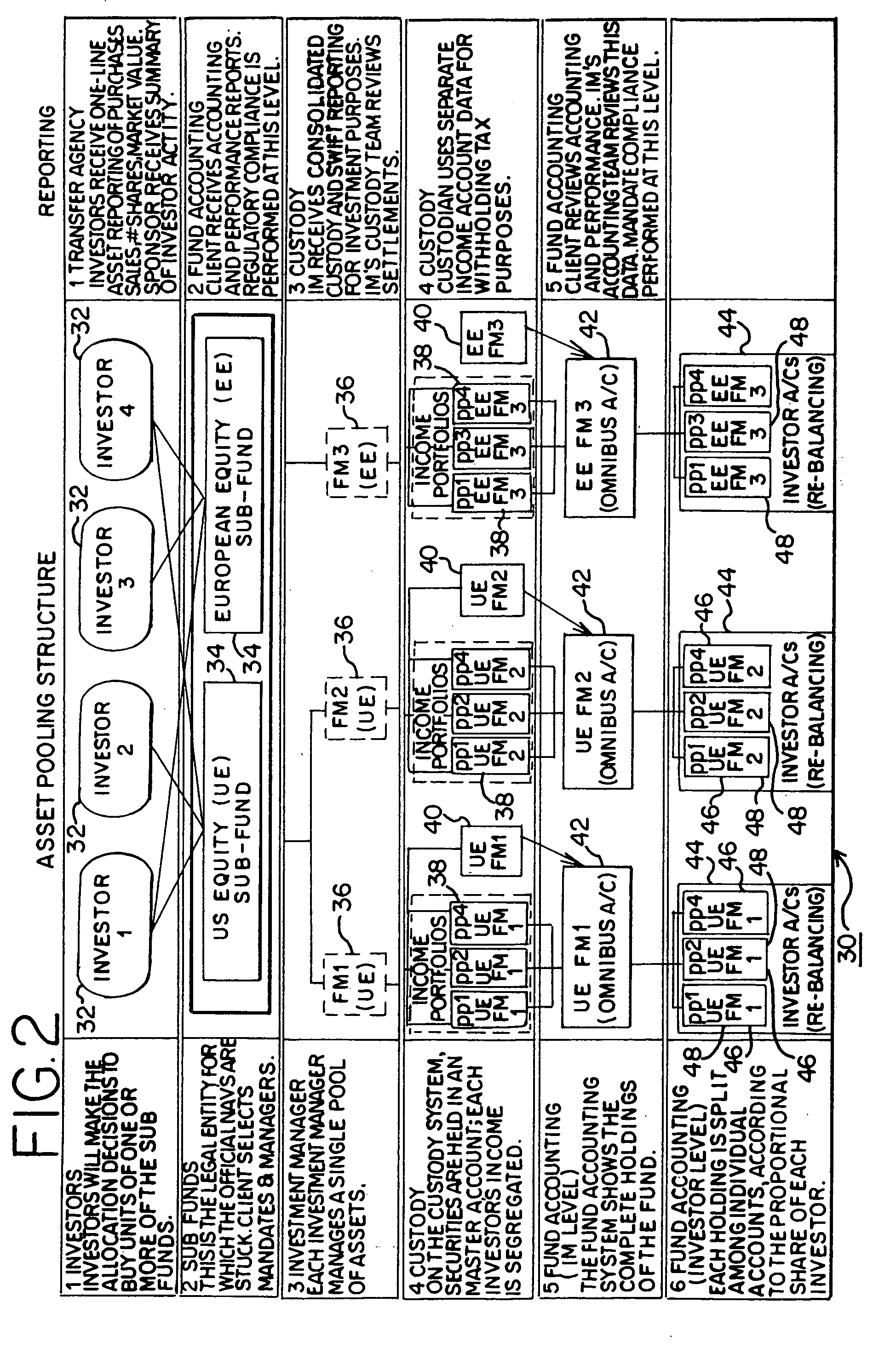

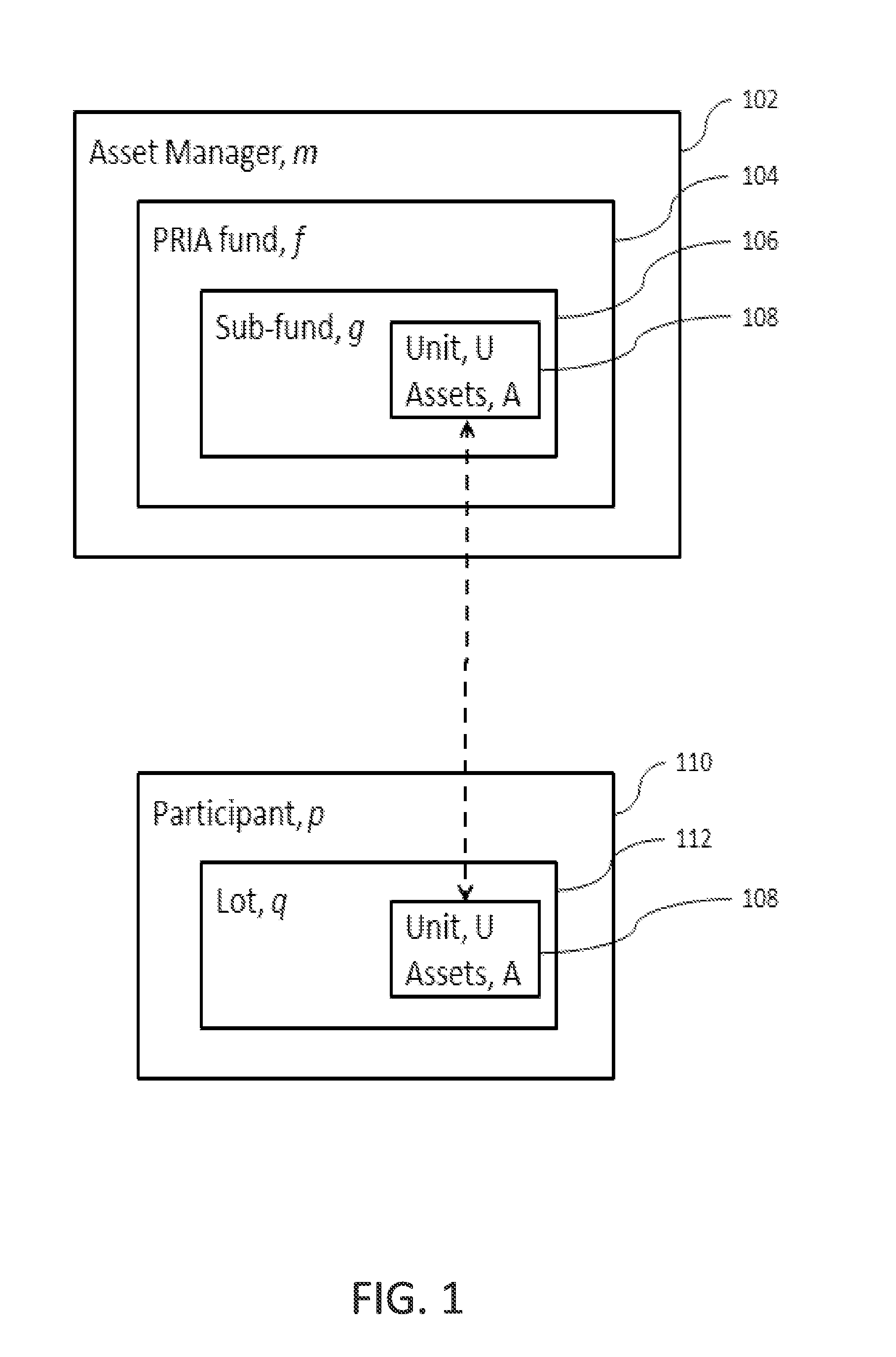

System and method for pooling of investment assets

A system and method for pooling of investment funds enables a multinational corporation to cause its employee benefit plans from multiple international jurisdictions to pool their investments into a single entity, which invests in various financial products including exchange traded debt and equity securities as well as other securities. The entity is preferably structured as an offshore pooled vehicle, which may have one or more sub-funds that vary by investment objective and / or eligible investments. Each pooled vehicle is preferably organized as an Irish CCF, a Luxembourg FCP, a Dutch FGR or other tax-transparent vehicle. The investors in such pooled vehicles and sub-funds are preferably the employee benefit plans of the multinational corporation. A banking or trust organization that is duly qualified and licensed to act under the laws of the applicable jurisdiction as a management company for the pooled vehicles will act on behalf of the applicable pooled vehicle.

Owner:NORTHERN TRUST COMPANY THE

Comprehensive improvement for salt farm field soil and vegetative cover

InactiveCN101073807AWith growthIncrease planting areaContaminated soil reclamationSoil-working methodsEngineeringEarth surface

The invention is concerned with complex improvement method for farm soil and vegetation to salina. It carries the improvement about the soil with 0.4 m thickness, relating to cutting piece, digging main pouring blind drain and branch pouring blind drain channel, making small square farmland filled with clear arsenolite, backfill soil and return to even, beat sand hole, making fall of slope, wash salt and eject salt, fertilization and tillage deeply. The improvement soil is fit for all kinds of crop, greensward and perennial flowers, and forms the soil for foodstuff crop, plant with shallow root and flowers. Its investment is low and the amount of a unit of area is at least 5000, and the improvement fee reduces greatly and it adds the plant area of farm and enhances the output of foodstuff and vegetable. It protects the soil resource to add the area of foodstuff planting, and it is an economic, extensive, simple and indirect technology for agricultural salina.

Owner:刘洪敏

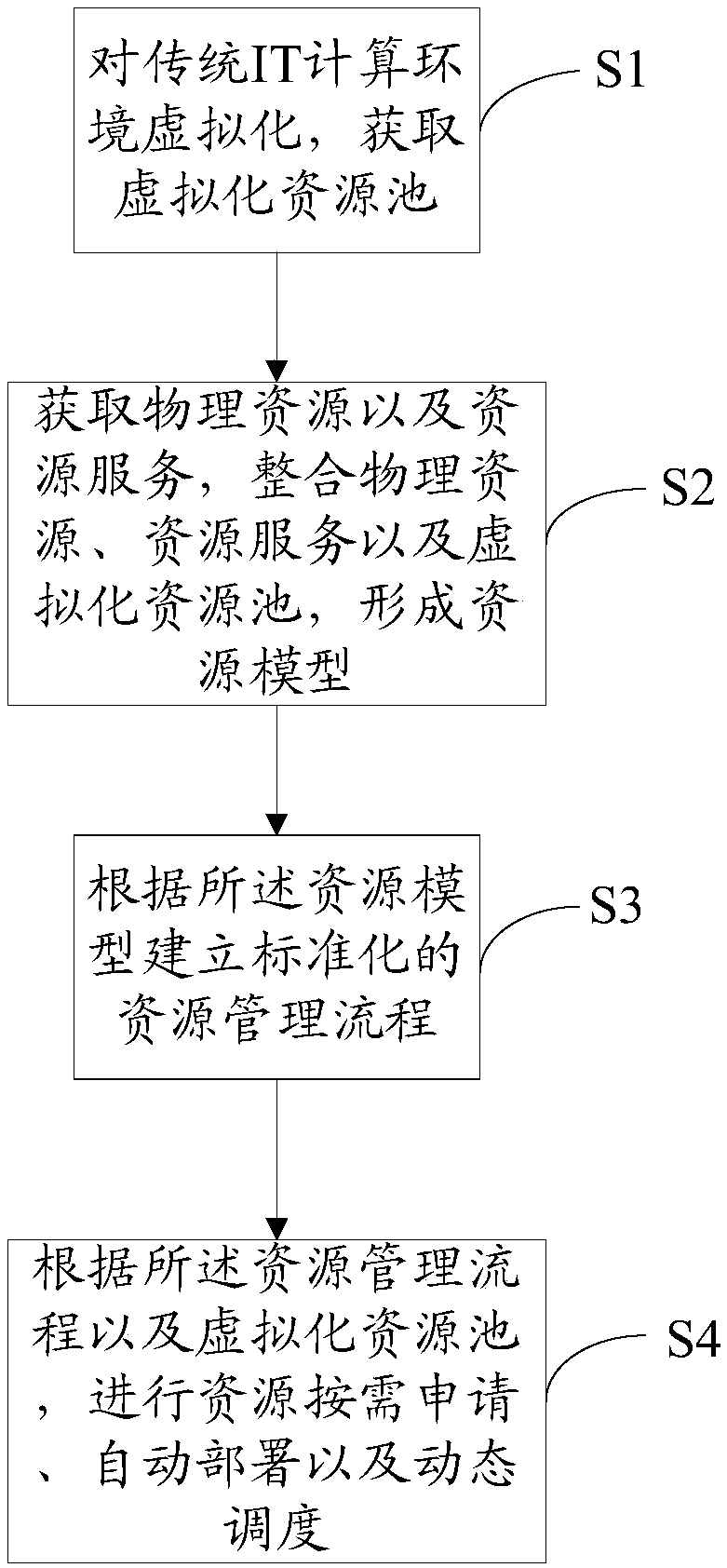

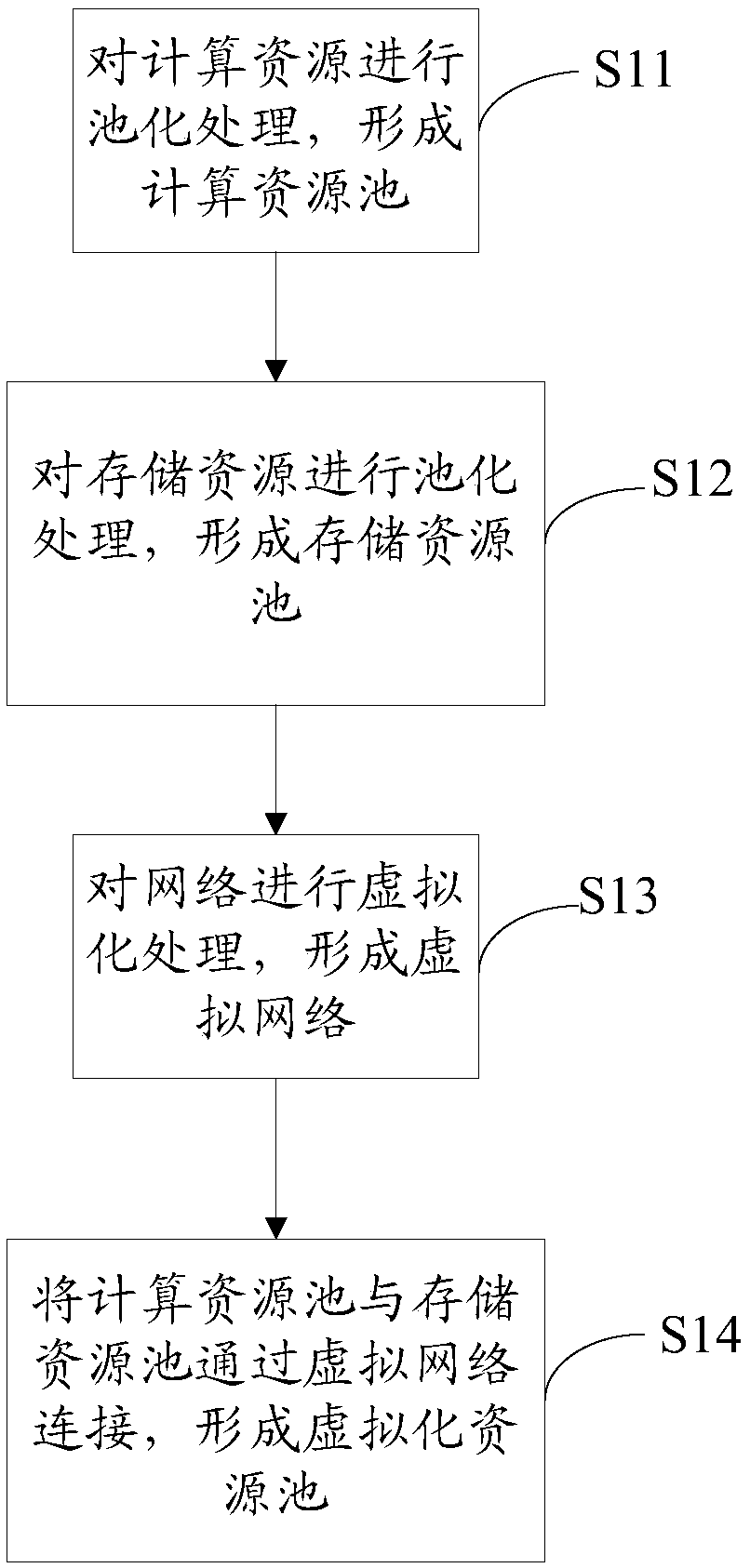

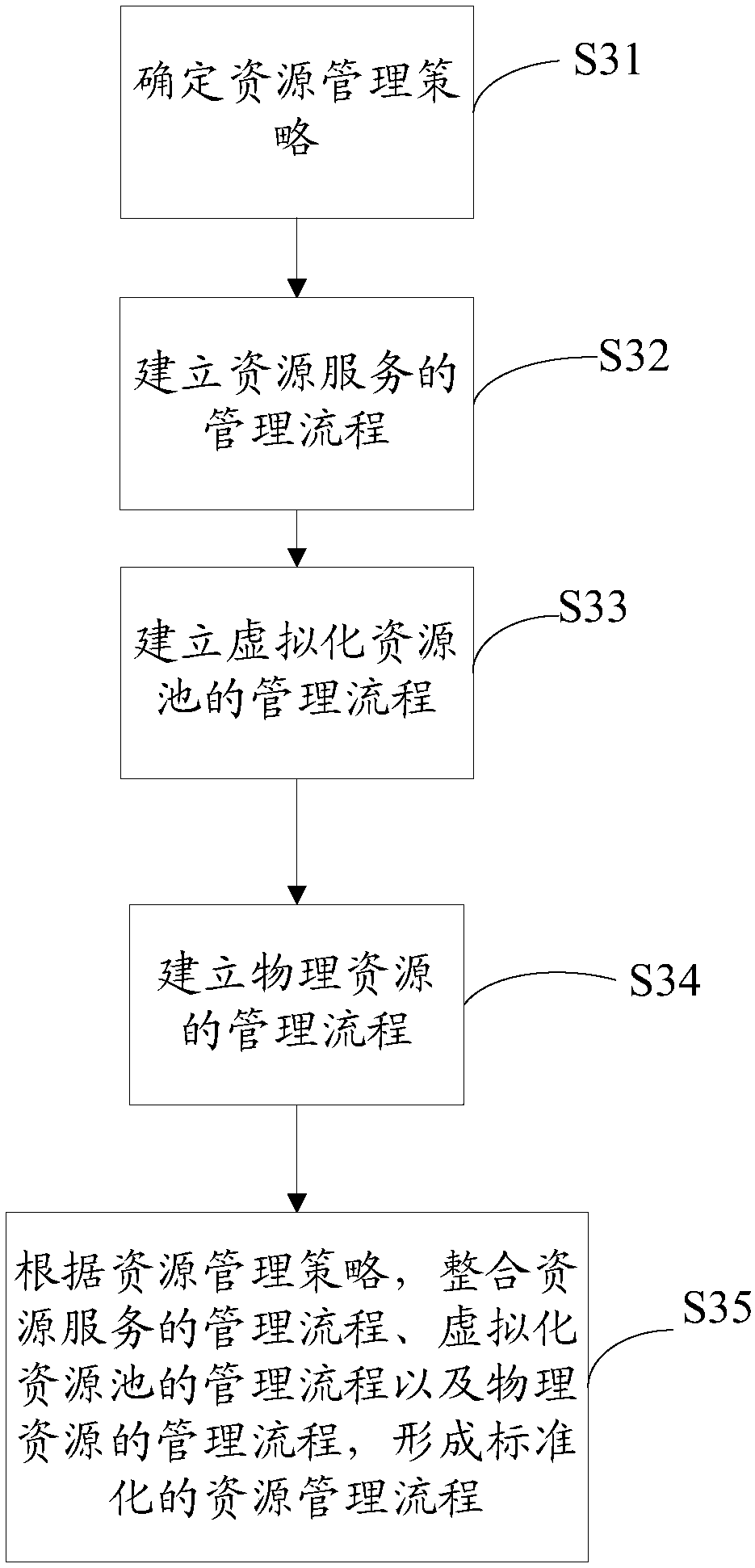

Resource uniform management method and system

InactiveCN107566184ARealize unified managementLow investment costData switching networksResource poolIt investment

The invention relates to a resource uniform management method and system. The method comprises the steps of virtualizing a traditional IT computing environment to obtain a virtualized resource pool; obtaining physical resources and resource service and integrating the physical resources, the resource service and the virtualized resource pool to form a resource model; establishing a standardized resource management process according to the resource model; and carrying out resource on-demand application, automatic deployment and dynamic scheduling according to the resource management process andthe virtualized resource pool. According to the method and the system, the traditional IT computing environment is virtualized to form the virtualized resource pool, a standardized resource management process is established for the virtualized resource pool, the physical resources and the resource service, and the resource on-demand application, automatic deployment and dynamic scheduling are carried out according to the resource management process. The physical resources and virtual resources of a data center are managed through a set of resource management system, the resource uniform management is realized, the management efficiency is improved, the relatively good fault tolerance and expansibility are achieved, and through resource efficient integration, the IT investment cost of an enterprise is reduced.

Owner:TIANYI ELECTRONICS COMMERCE

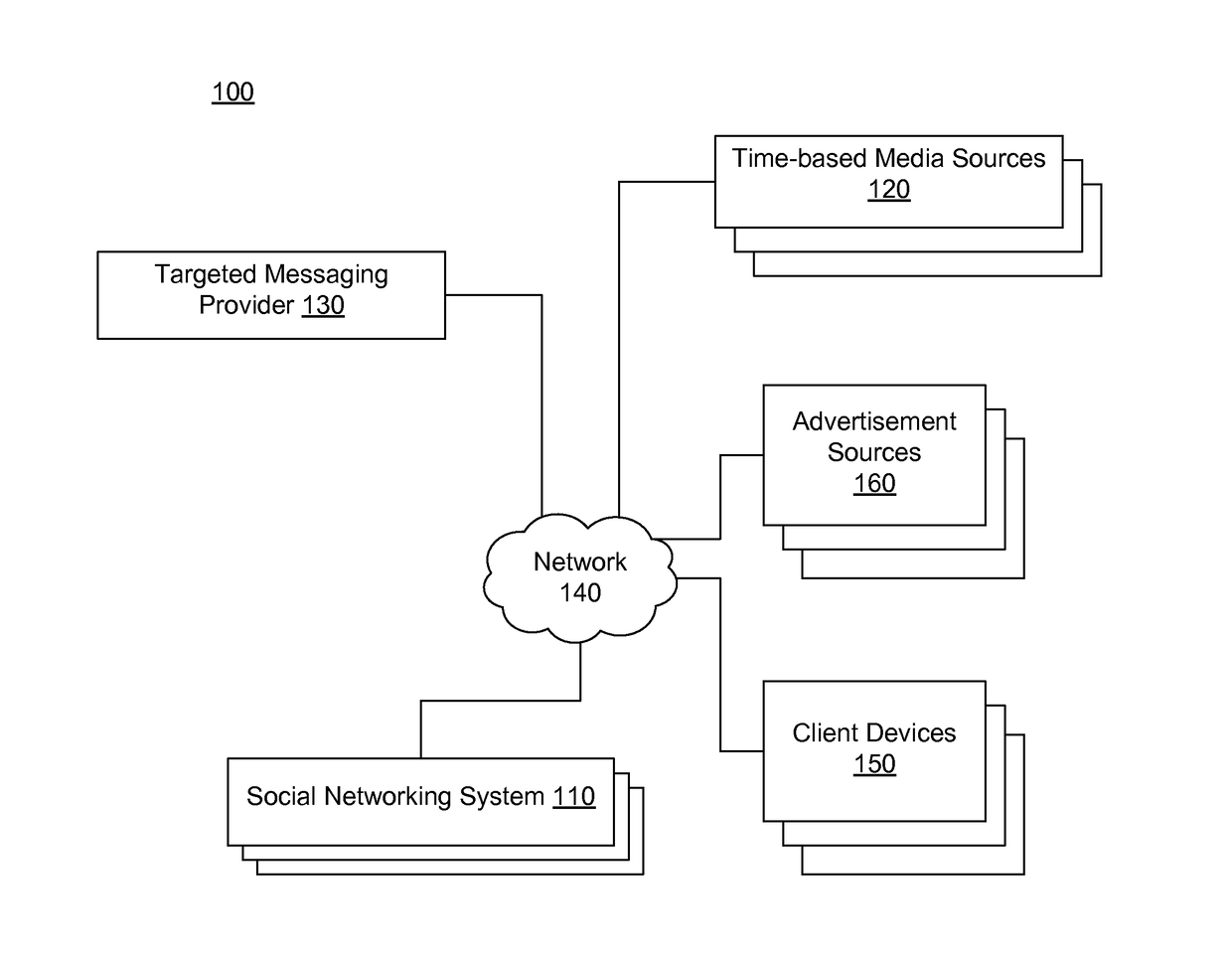

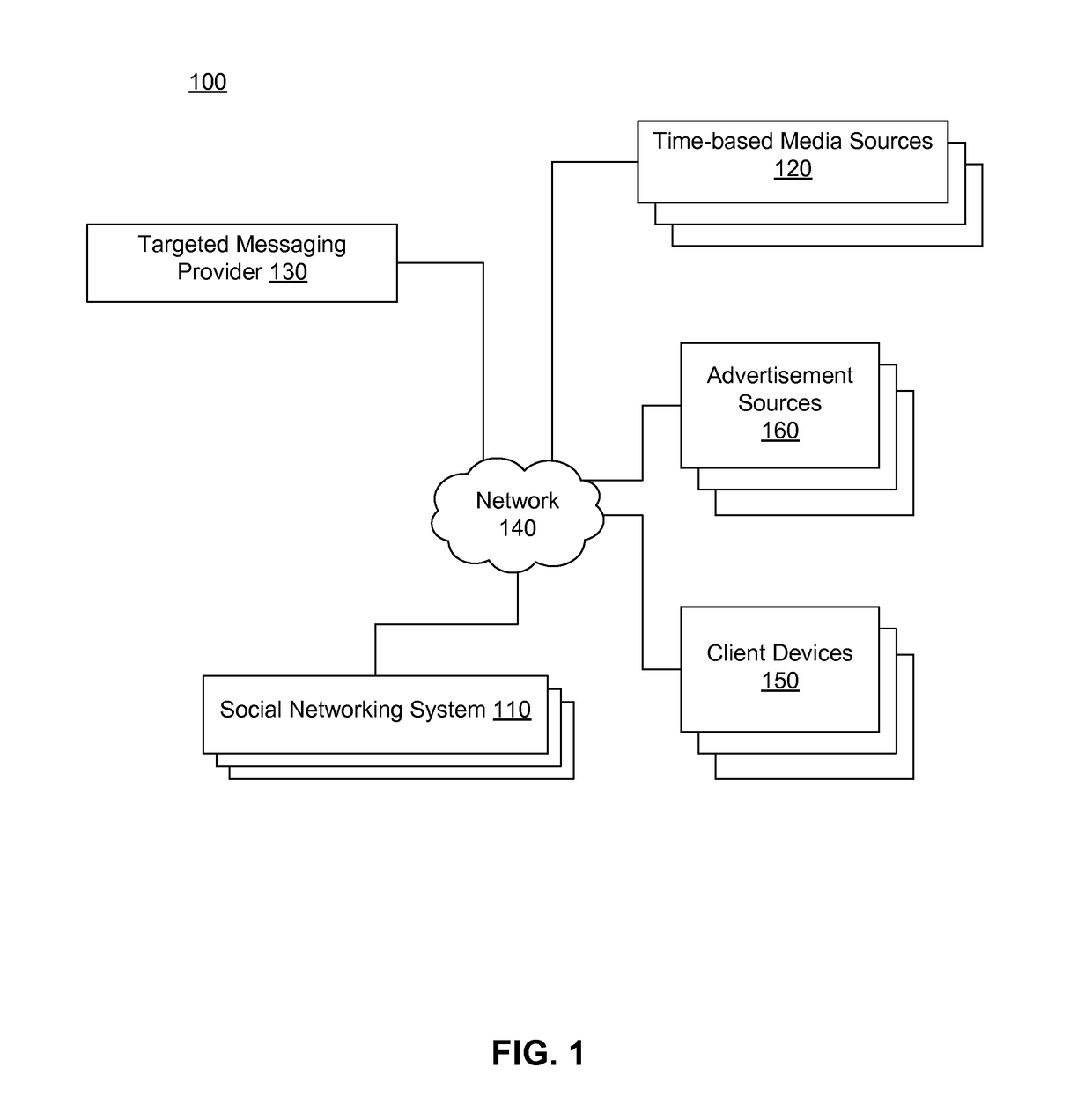

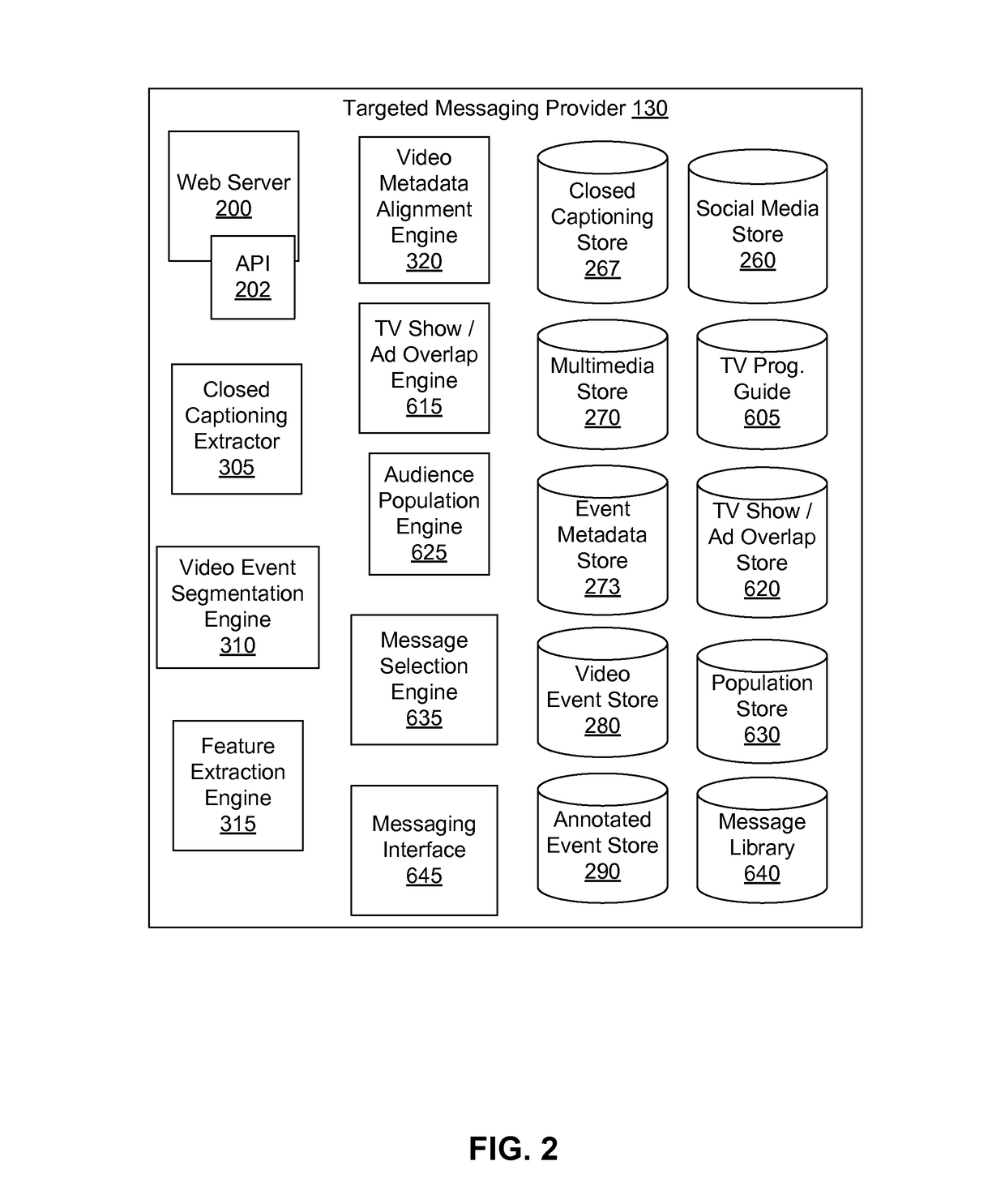

Social Networking System Targeted Message Synchronization

Targeted messages are sent to users of social networking system (SNS) based on the detection of airings of advertisements in time-based media. This approach allows advertisers to leverage their investment in, for example, television advertising by sending advertisements to SNS users who have likely seen the advertisements within shows that they have expressed interest in the context of a SNS. Time-based media streams are analyzed to detect the airings of advertisements within those streams. In one embodiment, SNS content items are received regarding individual users. Based on references in those content items between users and their interests, targeted messages may be sent to users. In another embodiment, targeted messages are sent to SNS users based on the airing of advertisements and targeting criteria provided by advertisers.

Owner:BLUEFIN LABS

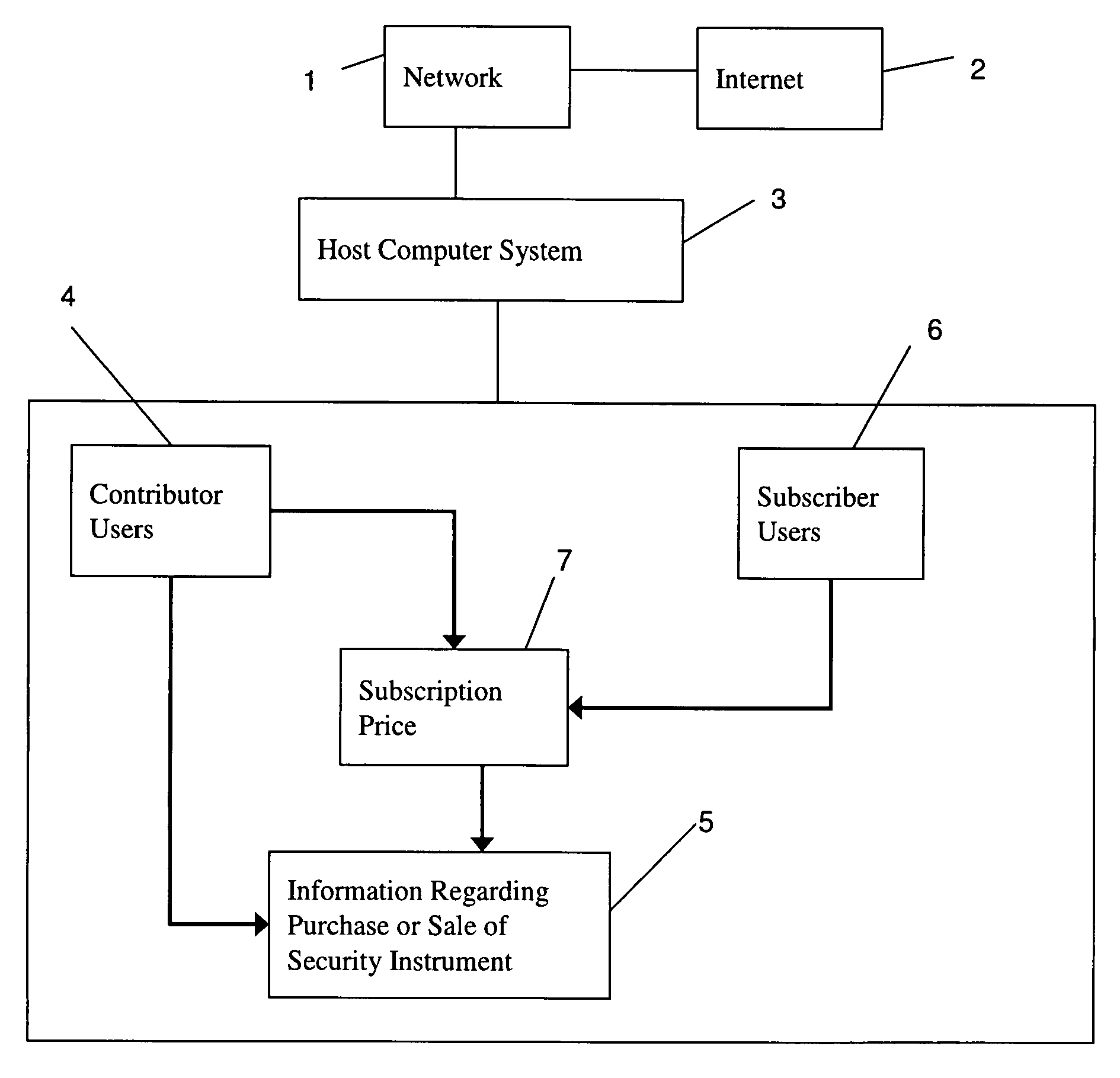

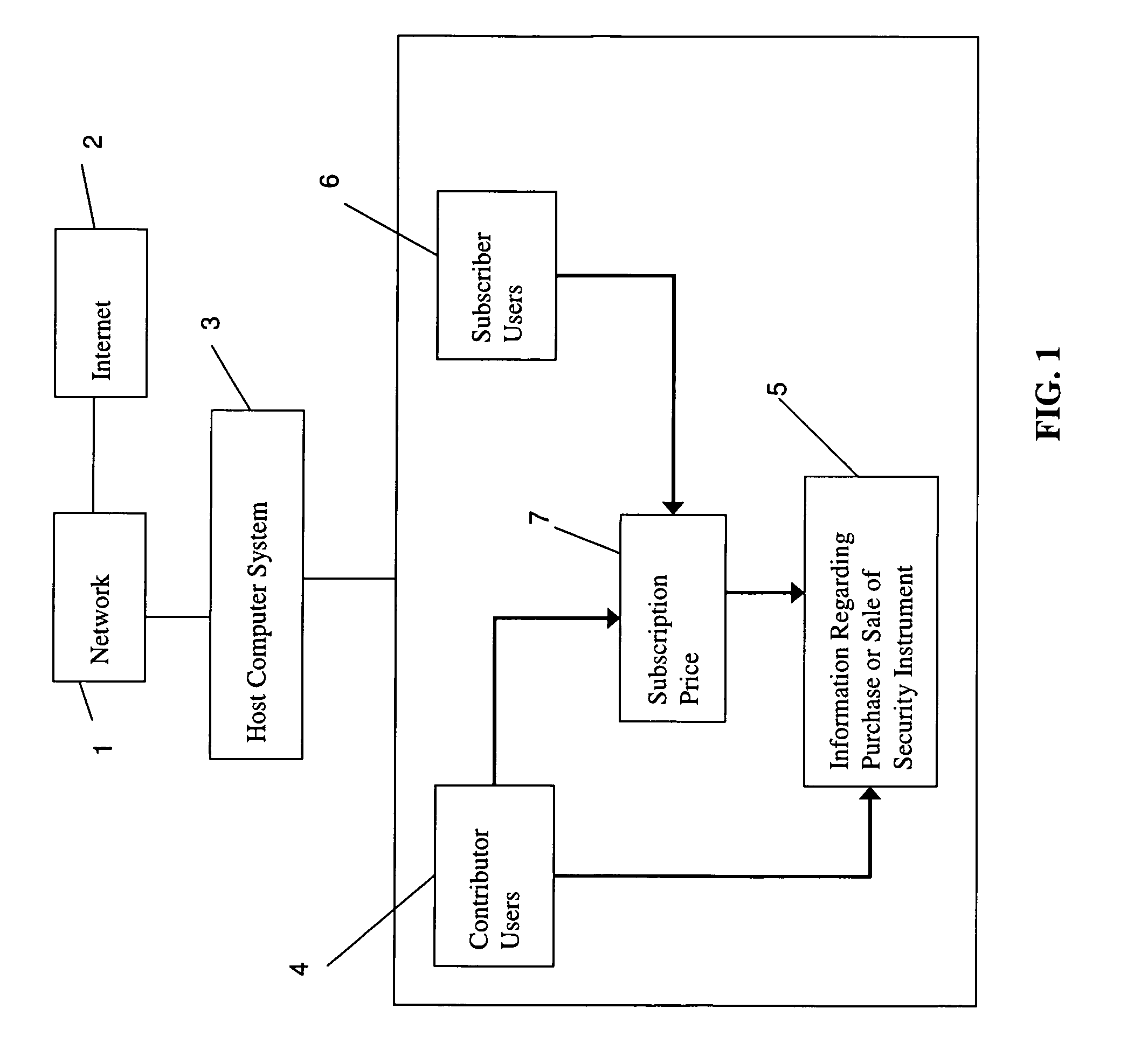

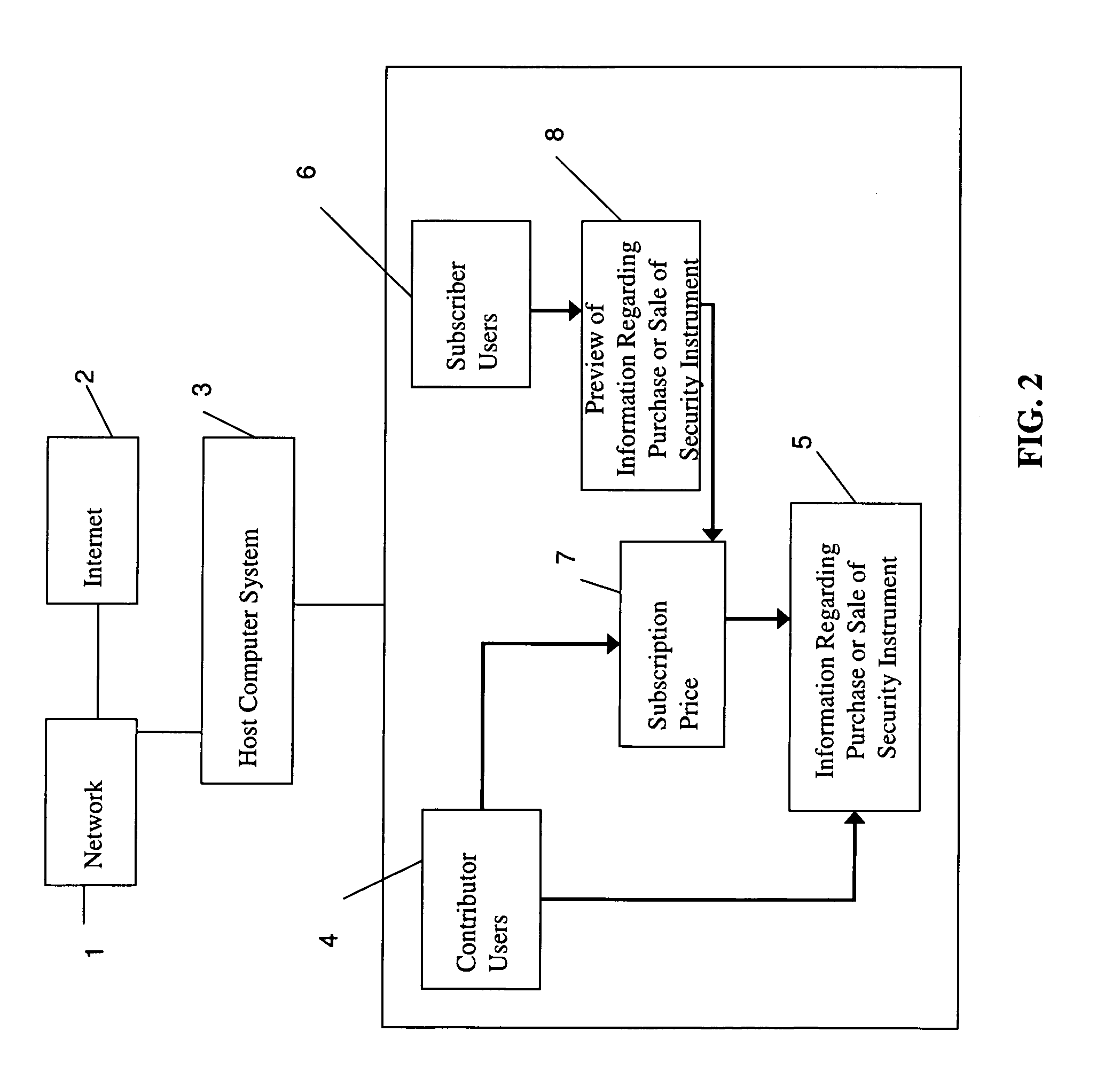

Method and System to Facilitate a User to User Subscription Based Online Marketplace for Real-Time Investment Data

InactiveUS20080270319A1High return on investmentEasy to findFinanceOffice automationIt investmentThe Internet

An online marketplace for real-time investment data is disclosed. The system comprises a network, such as the Internet, wherein users may manage, and publish a Virtual Securities Portfolio (“VSP”) and to sell / license access to the VSP to other users who pay to see the VSP. VSPs are analyzed, ranked and charted according to various customizable methods and made available, via a user interface, to other users according to the users' sell / license agreements. The system further allows the users to access their investment accounts on other networks, such as the TD-Ameritrade and Charles Schwab networks, and couple their VSPs with such accounts.

Owner:TORABI KASRA +1

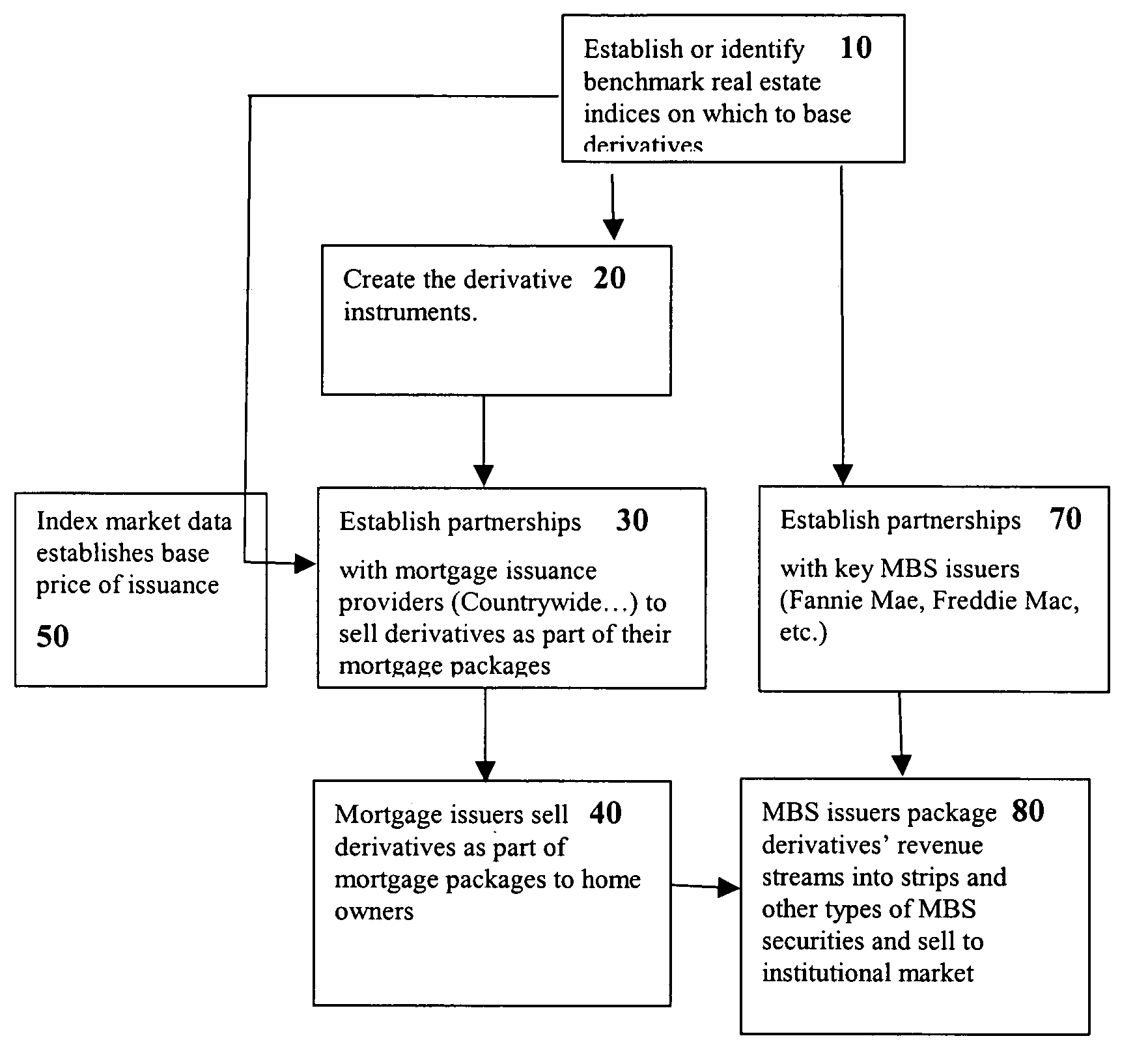

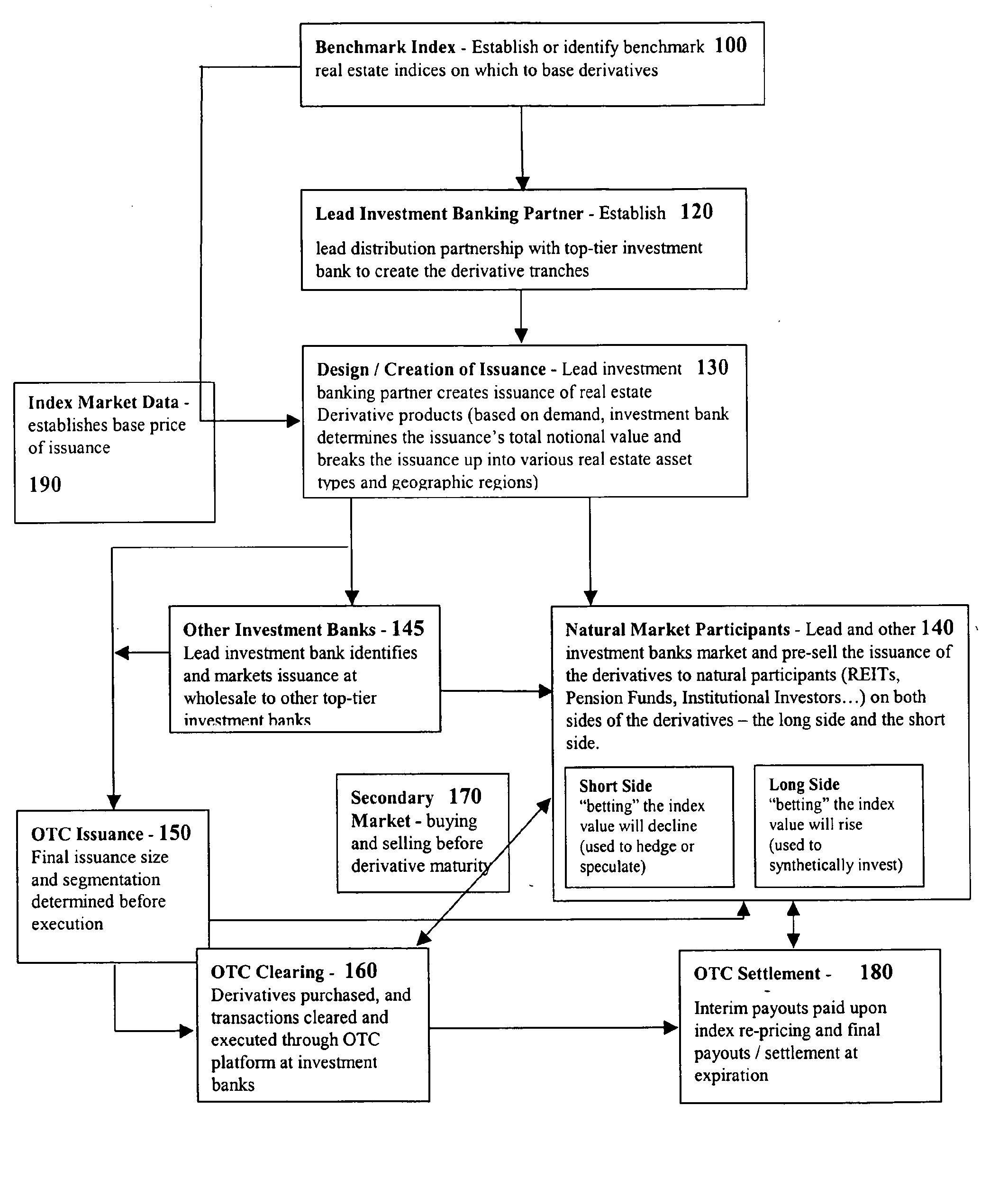

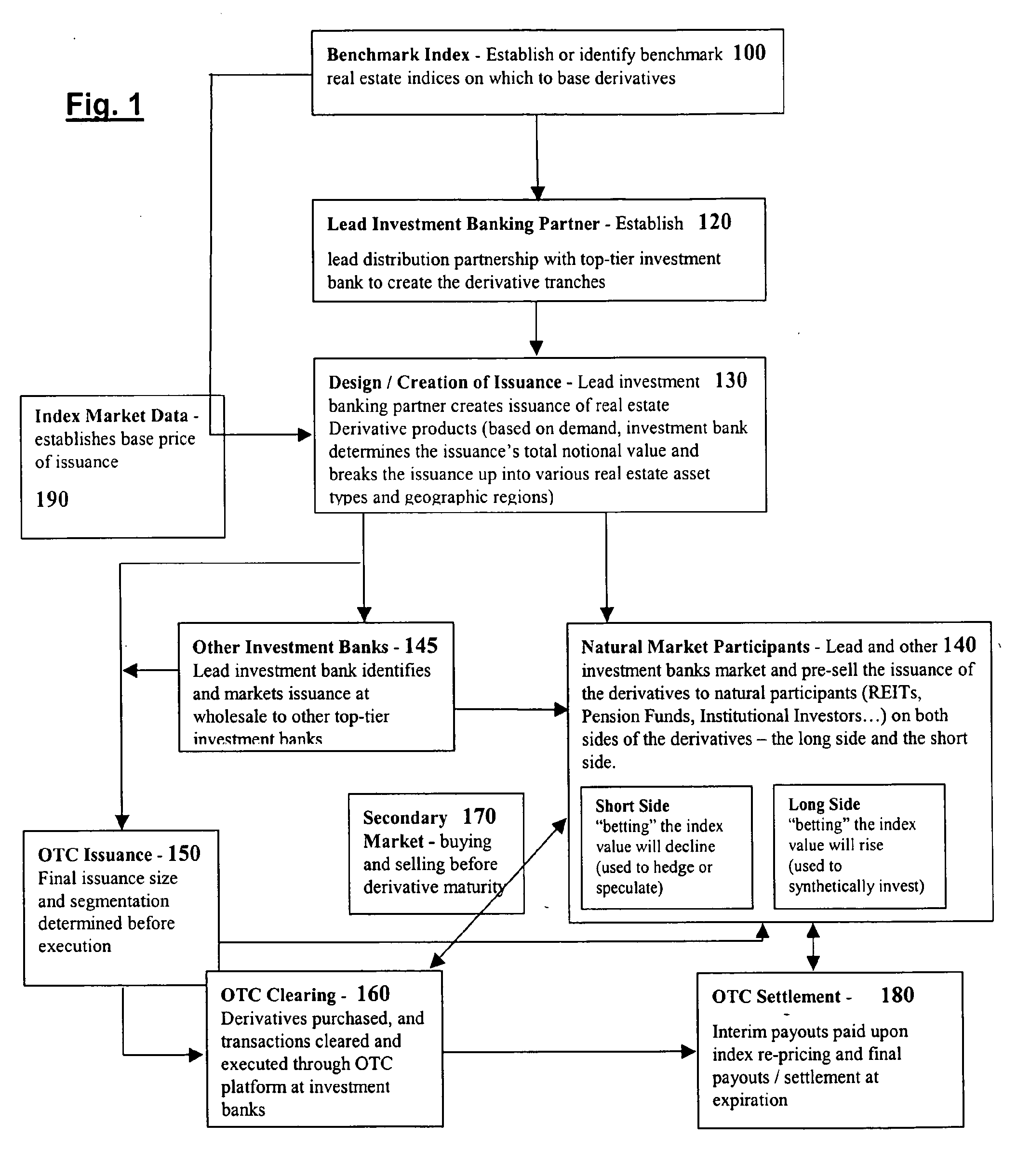

Real Estate Derivative Securities and Method for Trading Them

A method for creating and marketing a commercial or residential real estate derivative instrument in the form of a structured note, future contract, or call or put option that provides a cash-settled payout to the buyer at a predetermined expiration date defined by the derivative instrument based upon the occurrence of a required change in value of a benchmark real estate index between a first, e.g., purchase date and the expiration date. The real estate derivatives instruments of the present invention may be used by property owners, developers, and financial institutions to hedge against a possible devaluation of their real estate assets. Institutional investors may use the derivative instruments to speculate in the value of commercial or residential real estate in order to broaden their investment portfolios.

Owner:REAL ESTATE ANALYTICS LLC

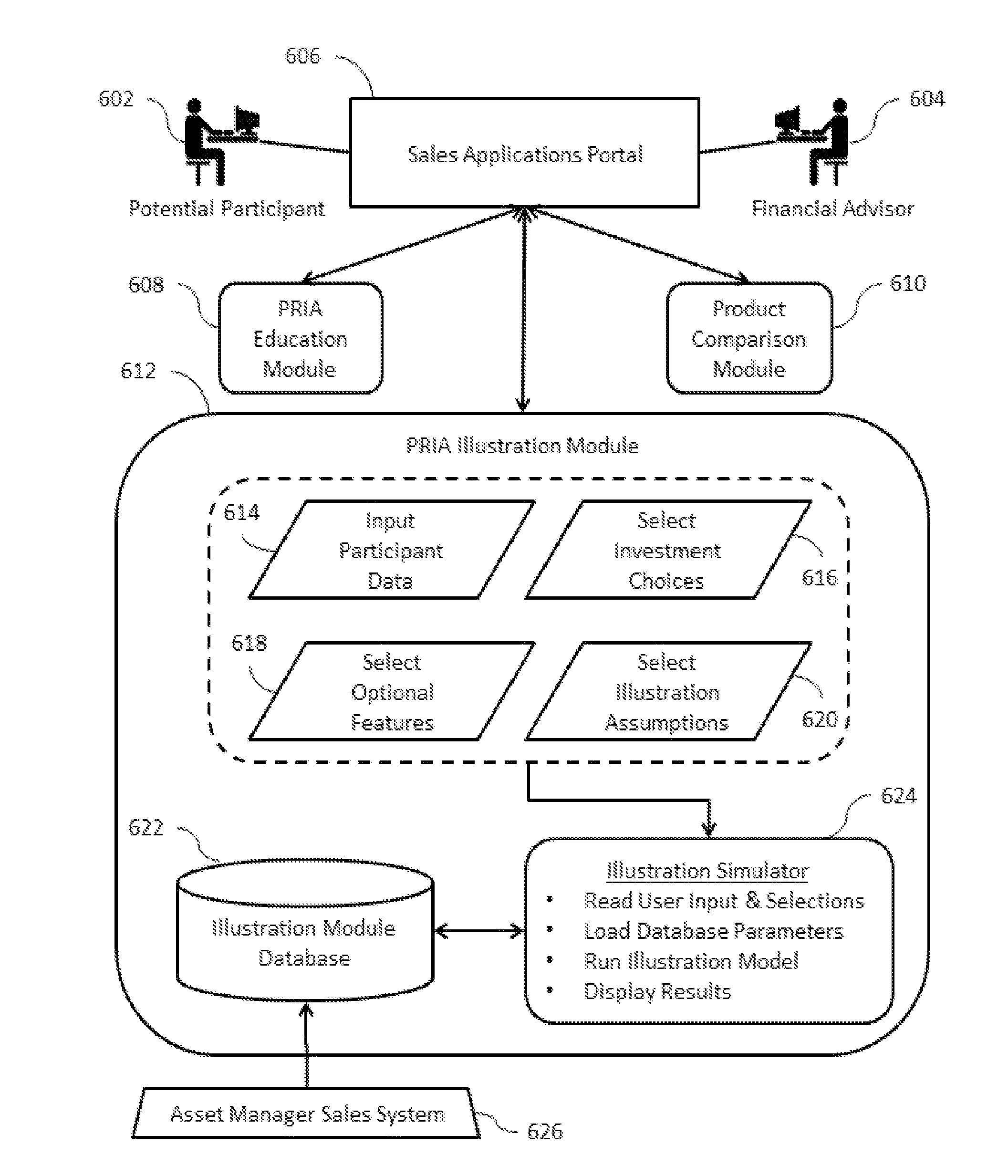

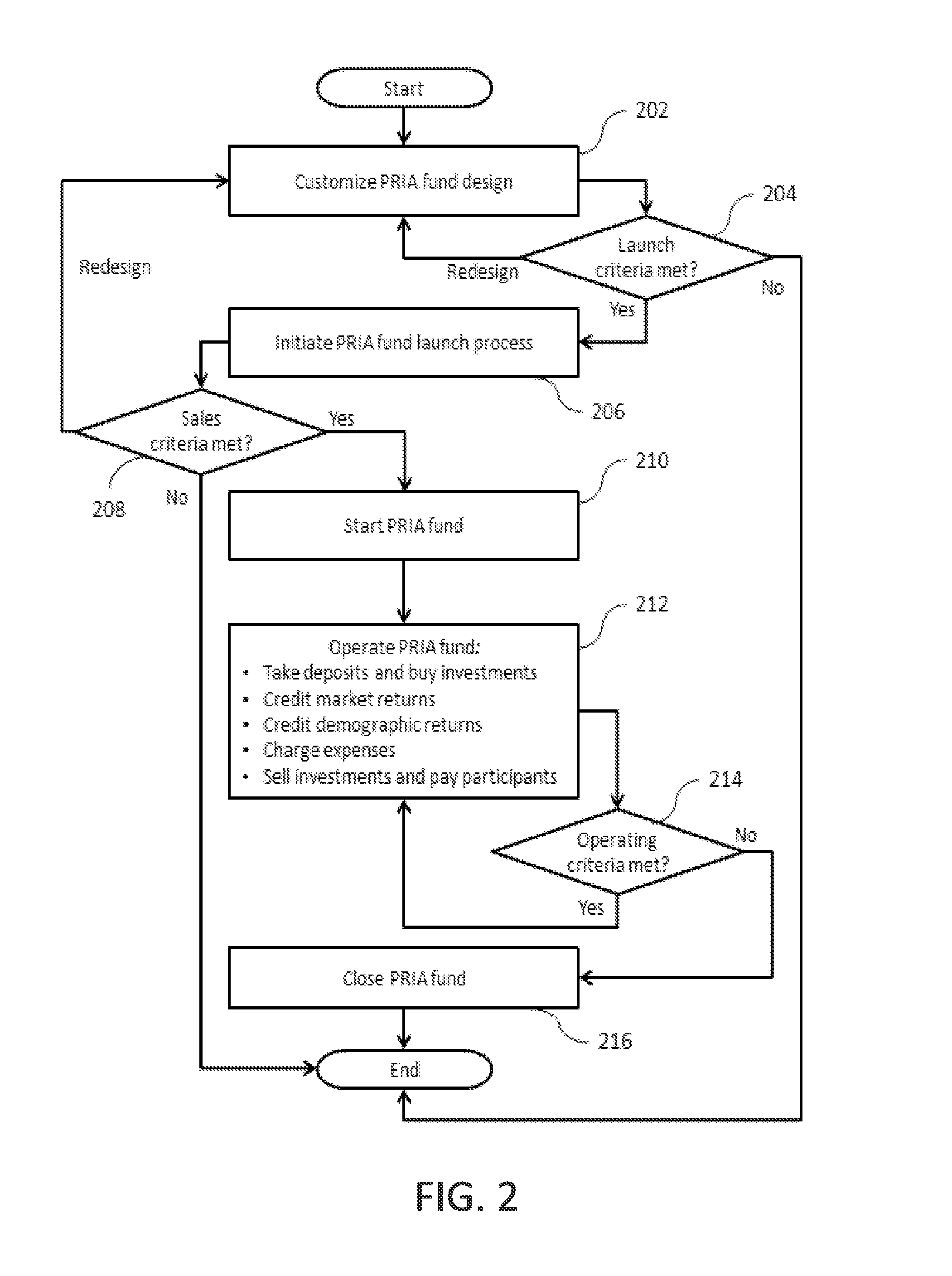

Interactive methods and systems for control of investment data including demographic returns

A computer-implemented method, system, and apparatus for managing investment savings of individuals through an investment vehicle suitable for retirement, estate or general investment planning. The invention establishes the mechanics of the operations to create an open-end investment fund as a means for individual participants to earn both market returns on their investments and demographic returns (DR) on the actual demographic experience of the pool of investors who participate in the investment fund. Individuals can invest in the fund and make additional deposits and withdrawals at any time. Investors specify a payout schedule, and those who sell their investments, as scheduled, earn full returns, combining market returns and the DR. Investors who make unscheduled withdrawals from the fund, receive lower returns. The investment fund is customized, and administered by computer software that is available to both participants in the fund and to asset managers who offer the fund to investors.

Owner:SHIMPI PRAKASH

Producer of bowled instant-noodles trade mark

InactiveCN101073932AIncrease productivityImprove yieldPaper/cardboard articlesIt investmentWaste product

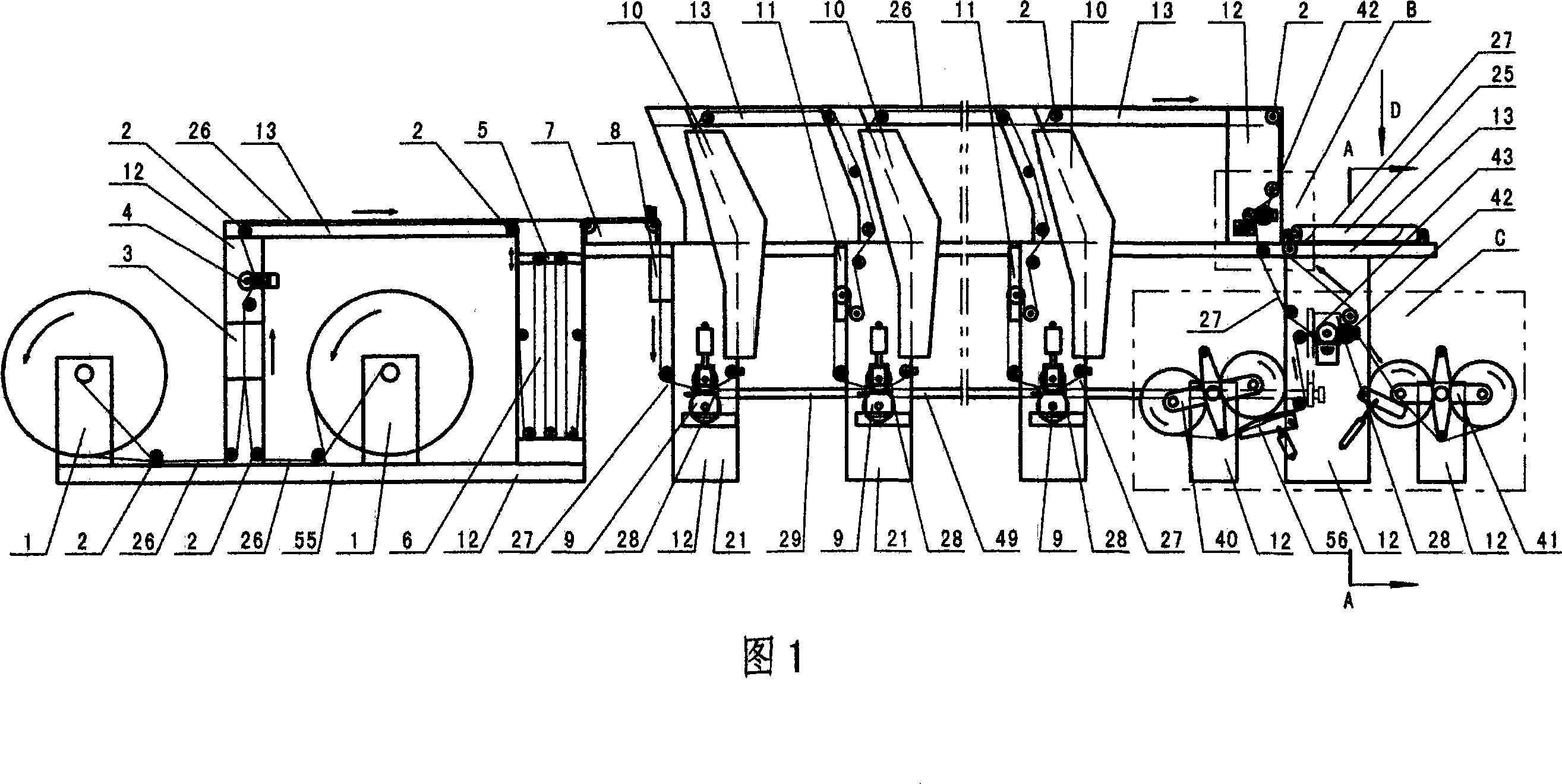

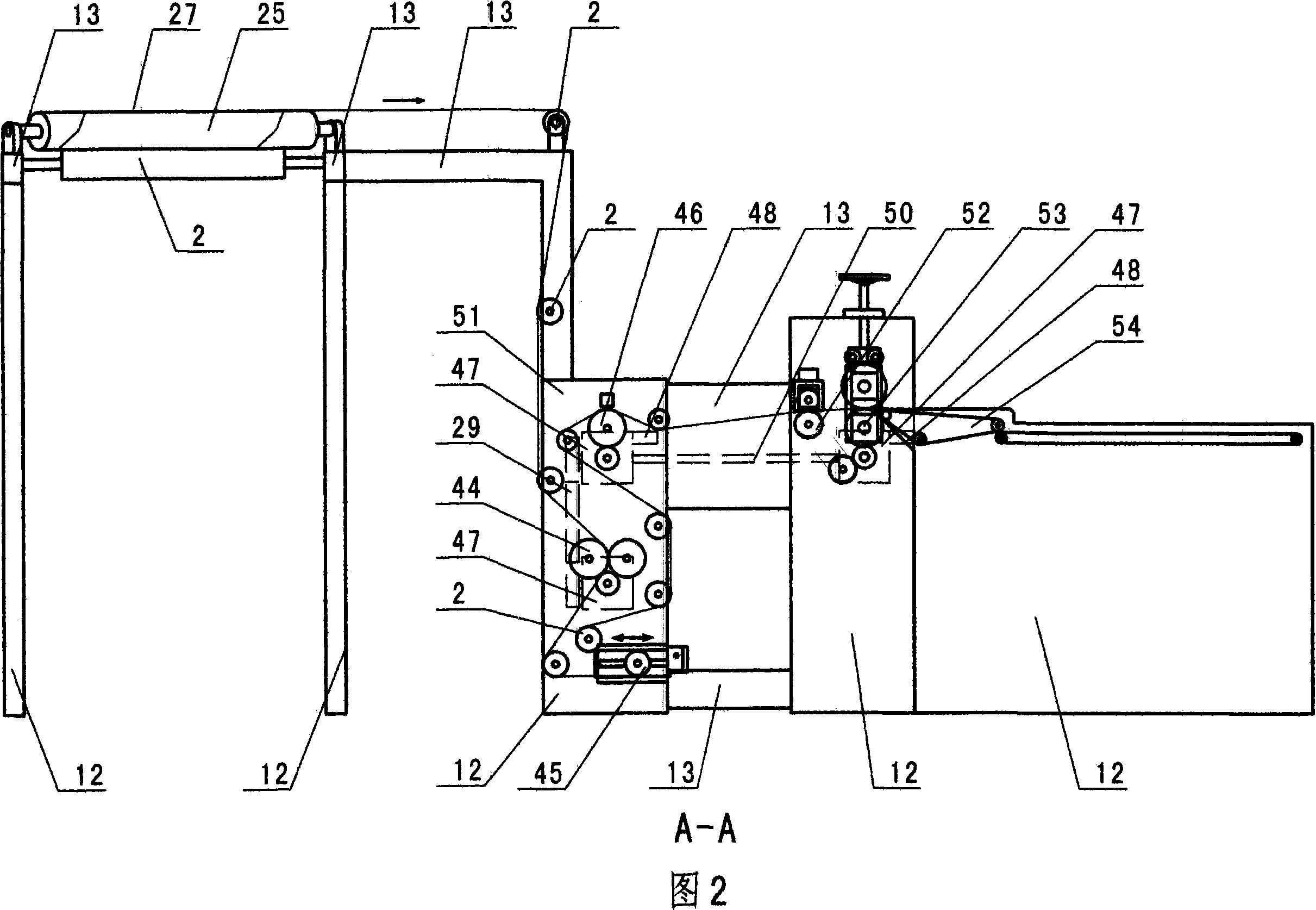

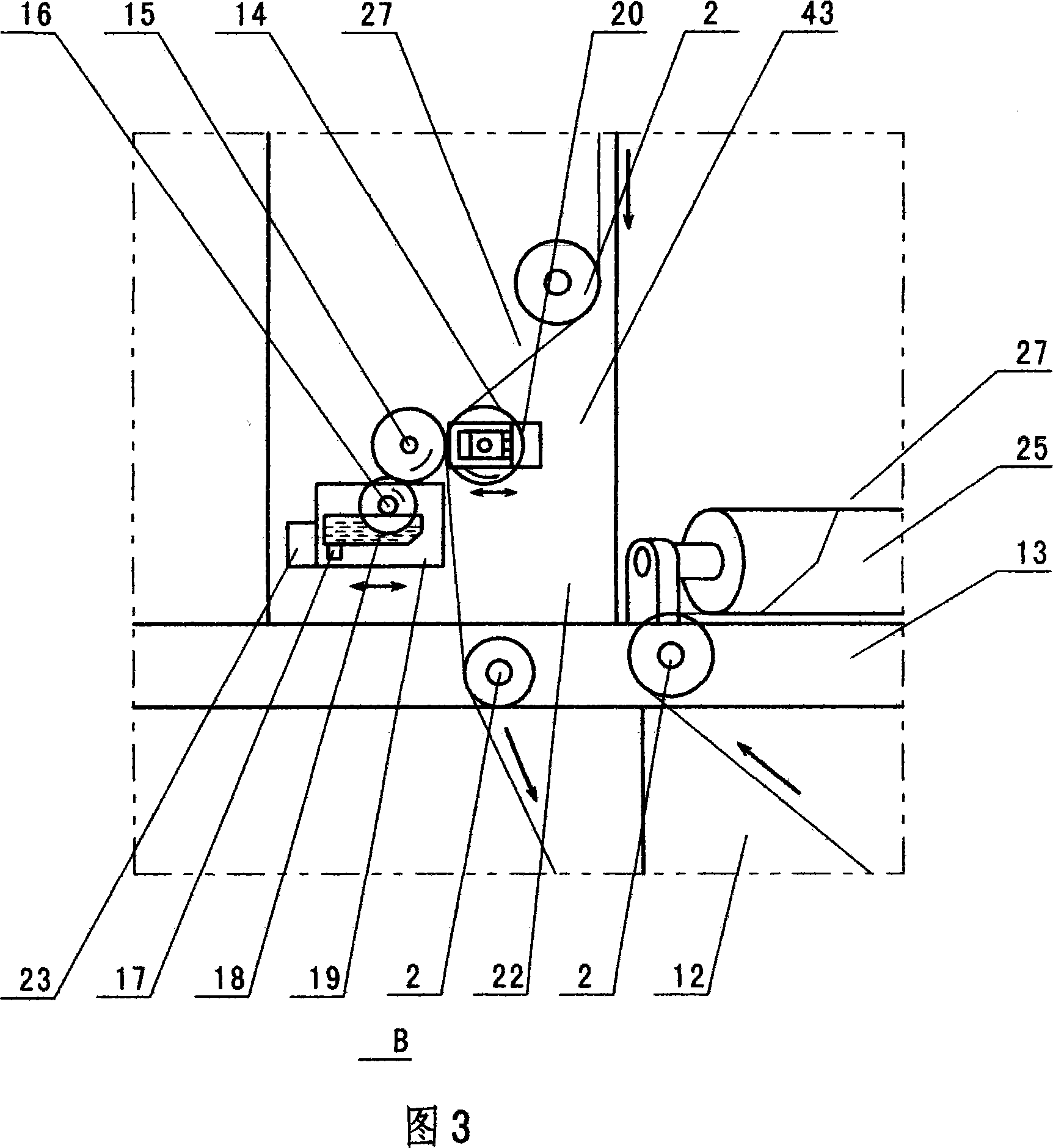

The invention is concerned with on line production equipment of noodles bowl's brand paper. Current technology is using offset printing machine to print on single stuff through unattached technology process for four to five times and four to five equipments respectively. Its investment is large and each process has waster. This production equipment relates to rigidity integer seat made of fixed rack and unite plate, and the fixed drive transmission framework, print unit, overturn rack, mirror calendering framework, continuous oil printing framework, contraposition framework, mould cutting framework, gathering framework, double positions roll putting framework without pause. The equipment realizes the on line production without pause to increase production efficiency with easy process, and finish in one time with high ratio of finished product. The work intension of worker is low and save raw and processed materials to realize production in large.

Owner:李玉龙

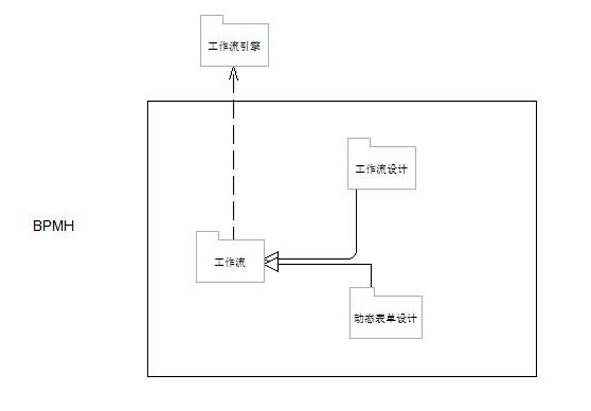

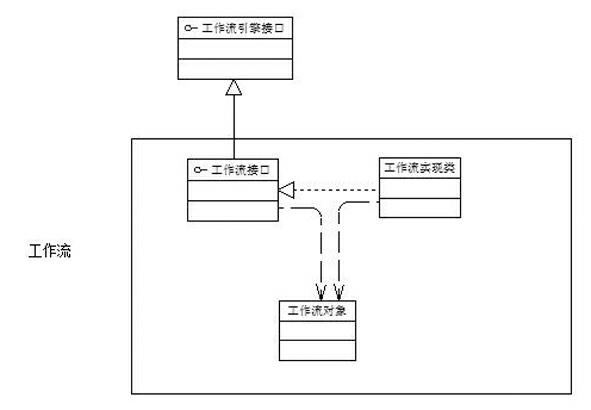

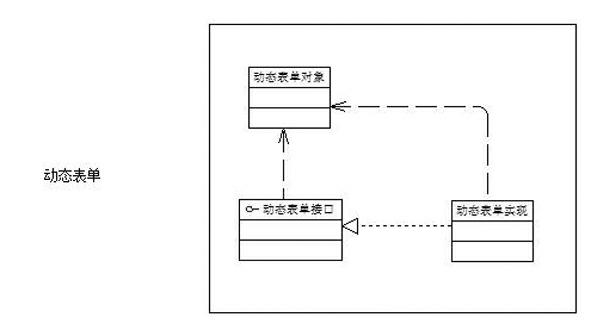

A business process management support method

InactiveCN102298740AImprove operational efficiencyImprove resource utilizationInstrumentsRational useIt investment

The invention provides a business process management support method, which includes the steps of selecting a workflow engine, encapsulating the interface of the workflow engine, defining the WEB process, and managing the WEB process. Through the integration of workflow, the present invention solves the increase of IT cost caused by the change of workflow engine, can effectively improve enterprise operation efficiency, improve enterprise resource utilization, protect enterprise IT investment, concentrate on processing core business, and popular workflow engine Keep synchronization, optimize and rationally utilize resources, reduce the running-in between the workflow engine and the enterprise, and improve its ease of use.

Owner:西藏万达华波美信息技术有限公司

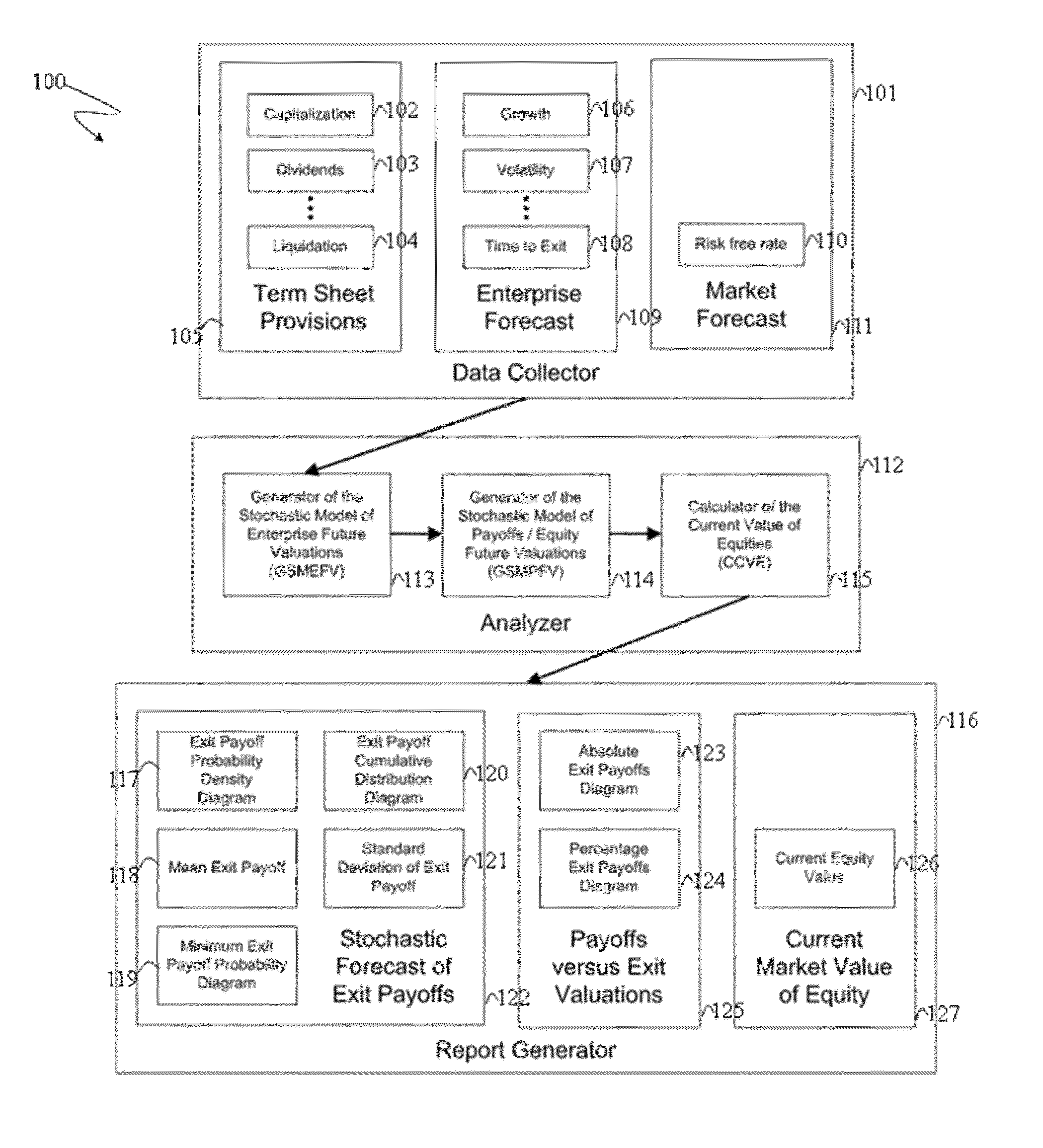

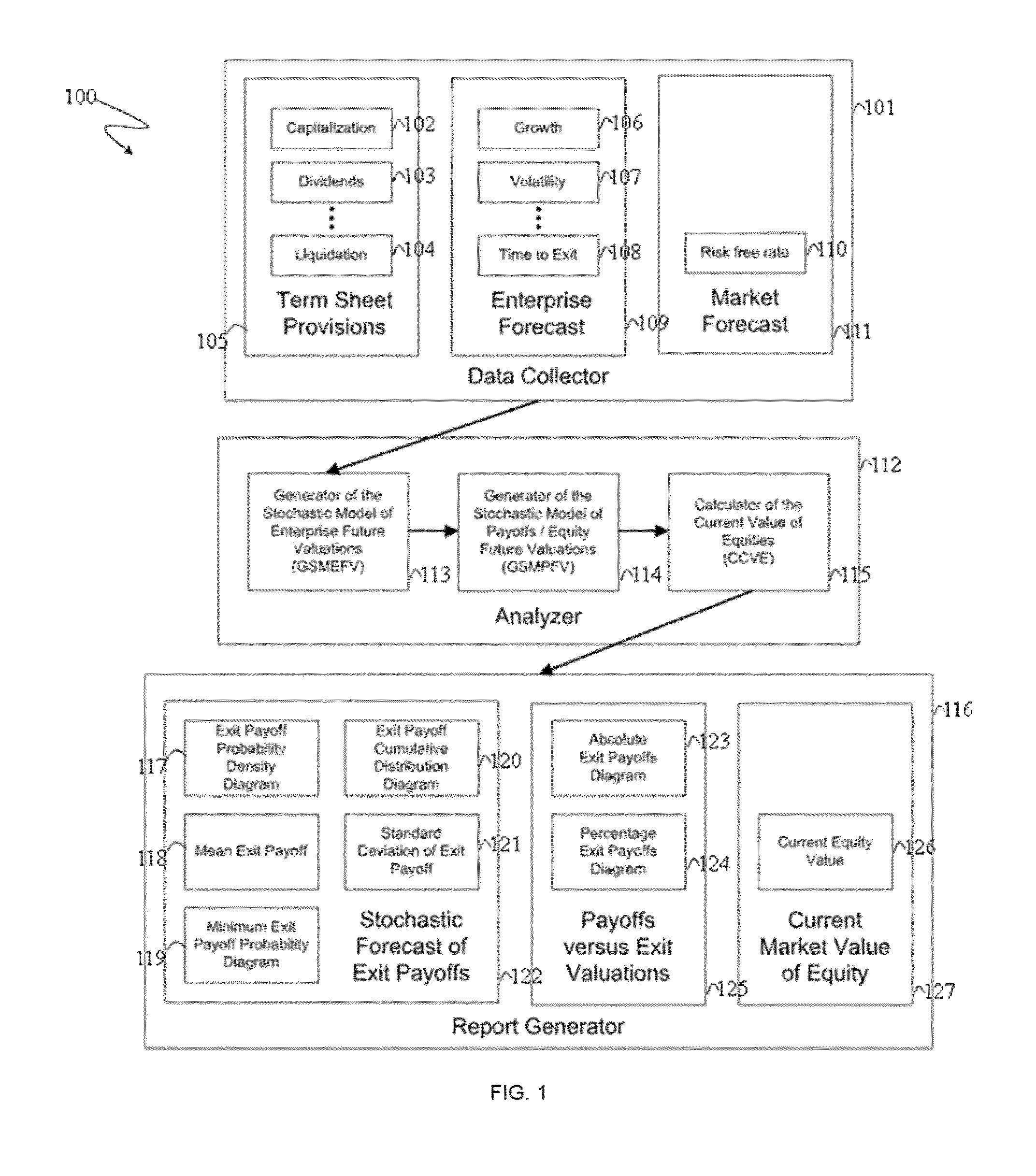

Method and apparatus for evaluating the impact of venture capital investment agreement provisions on payoffs to investors and entrepreneurs

A method and apparatus for evaluating an impact of enterprise investment agreement provisions on payoffs to equity holders, including investors and entrepreneurs. An investment agreement evaluator comprises a data collector, analyzer and report generator. One embodiment evaluates the impact of Venture Capital term sheet provisions. The data collector gathers information which includes term sheet provisions, enterprise forecasts and market forecasts. The analyzer determines the probability distribution for future payoffs to equity holders and estimates the current market value of equity held by equity holders. The report generator presents the evaluator results. Another embodiment analyzes definitive VC investment agreements. Other embodiments are described and shown through the use of the evaluator, entrepreneurs increasing their effectiveness in negotiating VC deals, VC attorneys expanding value-added services and increasing customer satisfaction. Venture Capitalists using the elevator increase returns for their investment portfolio.

Owner:SMYK DAREK

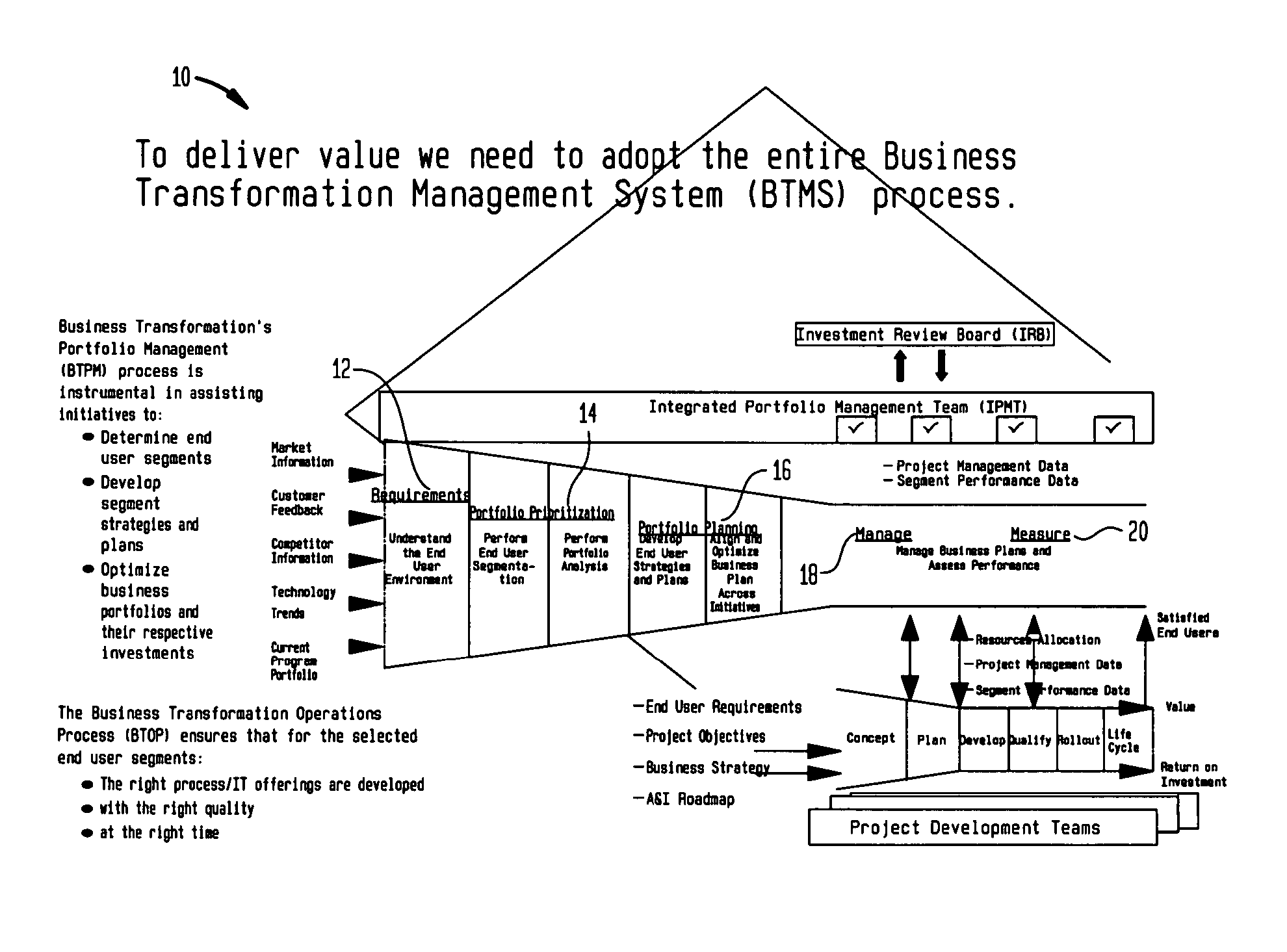

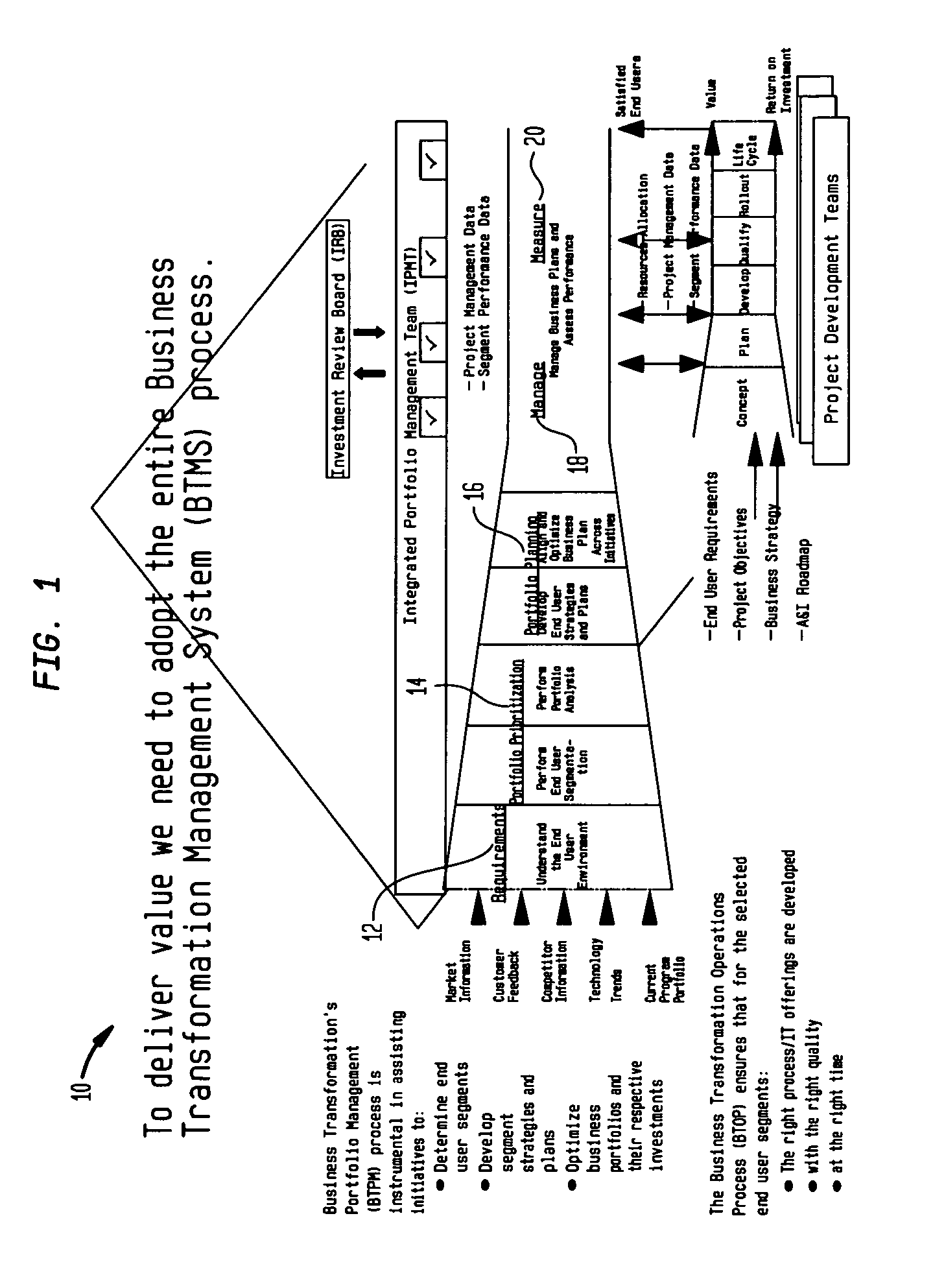

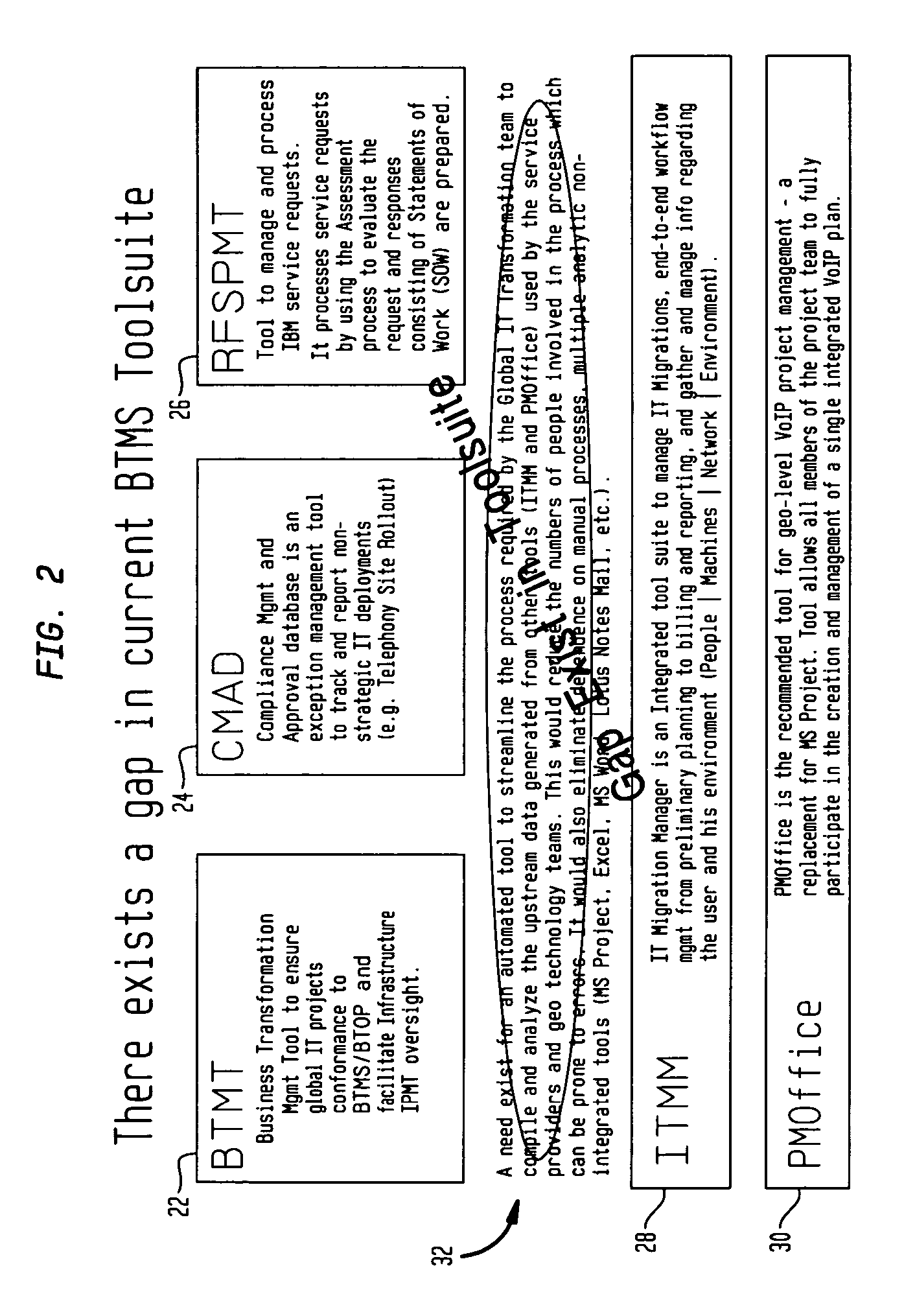

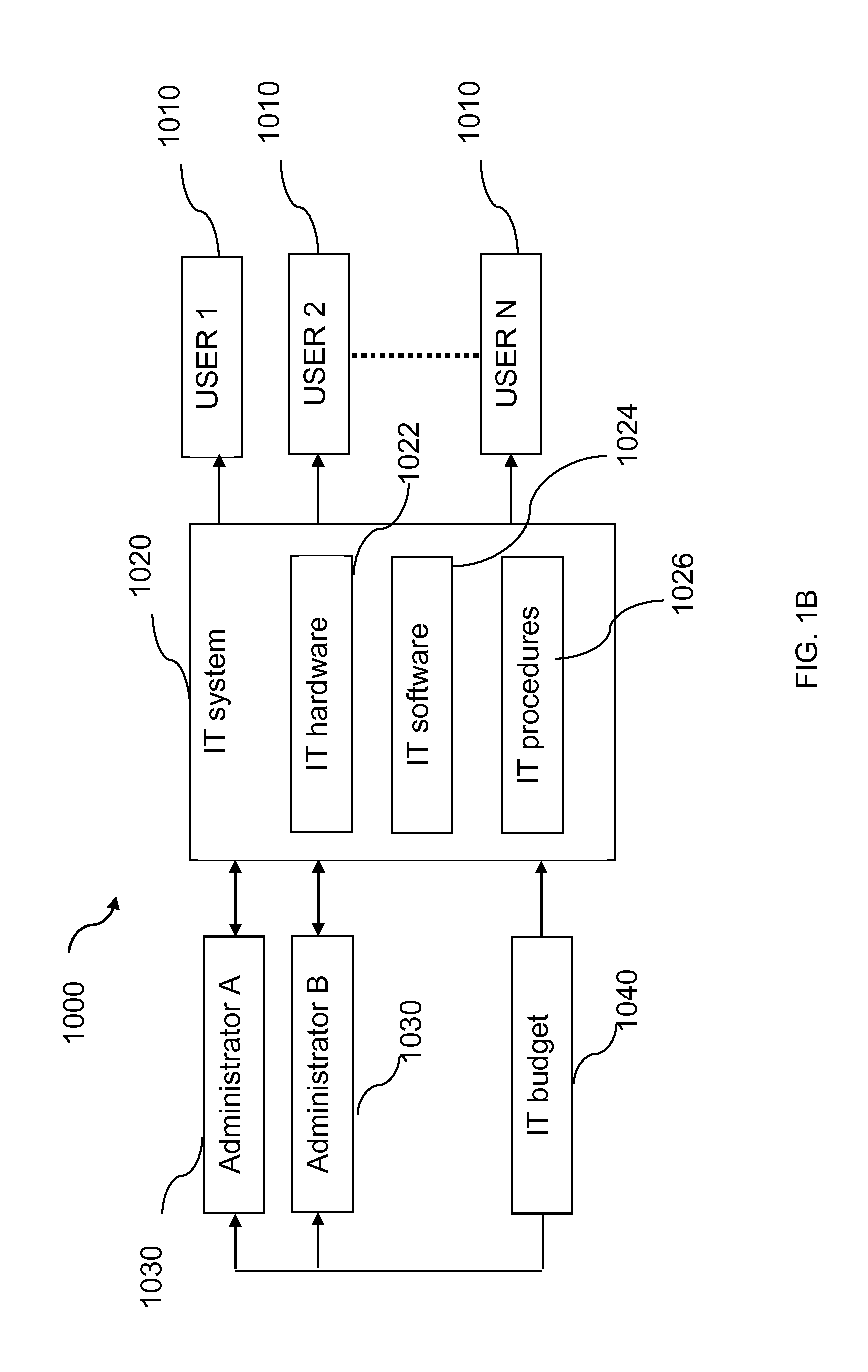

Global IT transformation

ActiveUS20070250368A1Efficient managementEffective informationMultiprogramming arrangementsPayment architectureVisibilityIt investment

Disclosed are a method of and system for providing a view of a transformation program. The method comprises the steps of providing an integrated and end-to-end set of processes, analytic tools, and reports that provide an information technology team with a comprehensive view of an information technology transformation; and using said set of processes, analytic tools and reports to provide a visibility to make objective business decisions about issues, including technology and activity and resource allocation. The preferred embodiment of the invention may be used in a number of specific situations. For example, the invention may be used in the implementation of IT investments, which are implemented in the course of an Annual Plan.

Owner:KYNDRYL INC

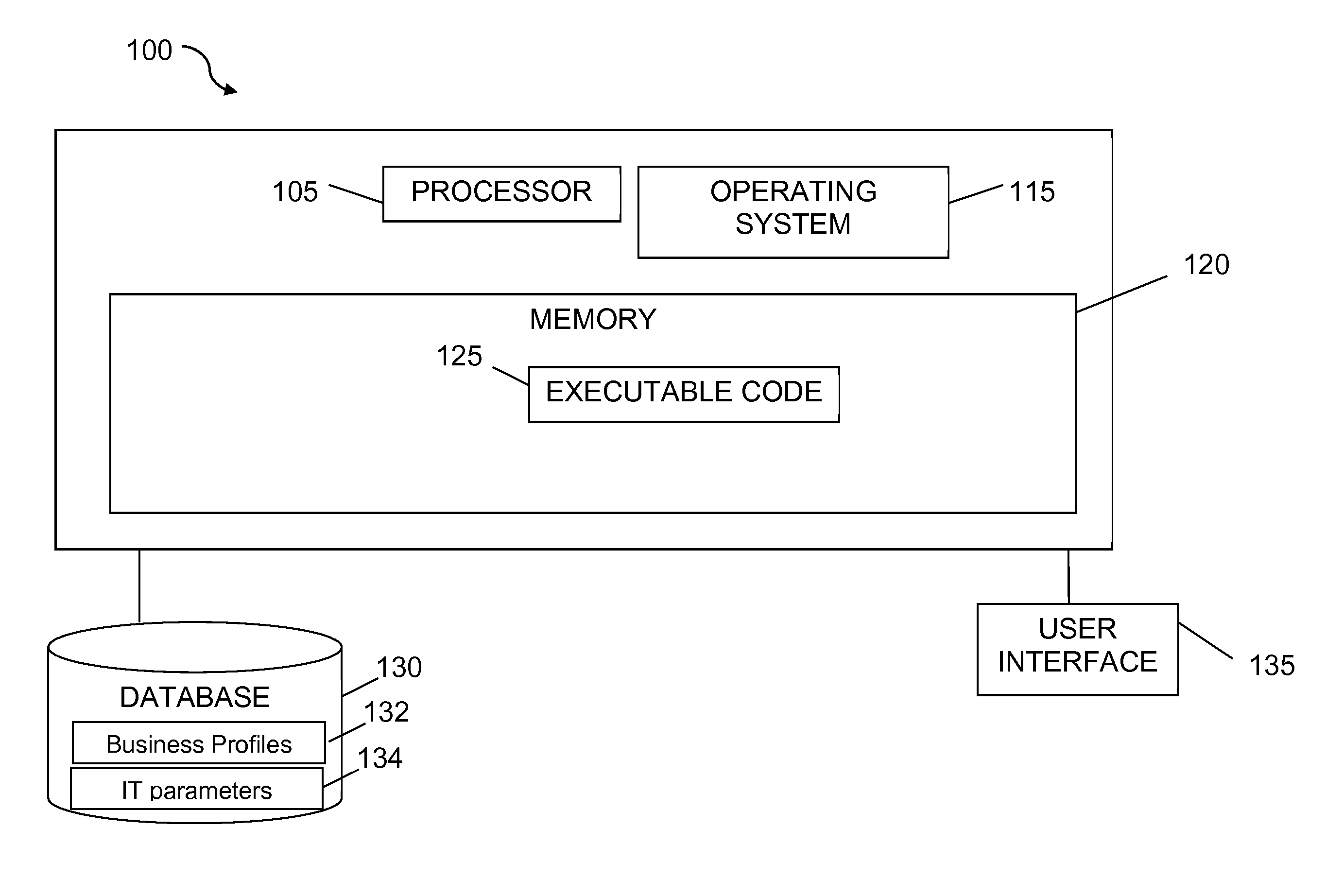

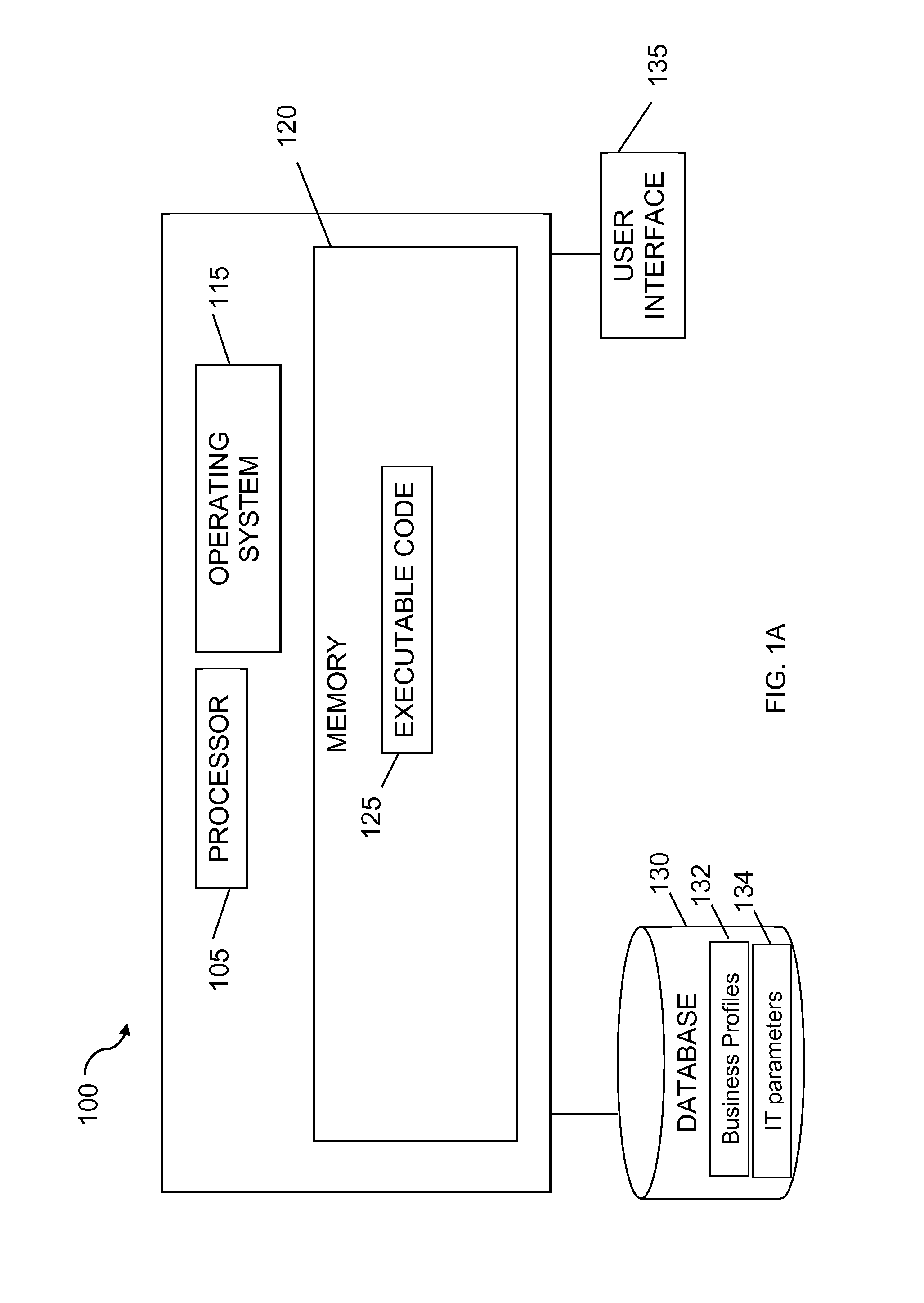

System and method of evaluating information technology (IT) systems

A system and a method of evaluating information technology (IT) infrastructure. The evaluation method may include receiving a value of an IT infrastructure parameter, for example, a value of a data protection parameter, a value of service availability parameter and / or a value of the IT investment parameter, for a first IT infrastructure. A business profile associated with a user of said first IT infrastructure may be received and a plurality of IT infrastructures associated with said received business profile may be identified. For each of said identified plurality of IT infrastructures representative values of IT infrastructure parameter may further be identified. The evaluation may include comparing said received value with said representative values.

Owner:I T ANALYZER

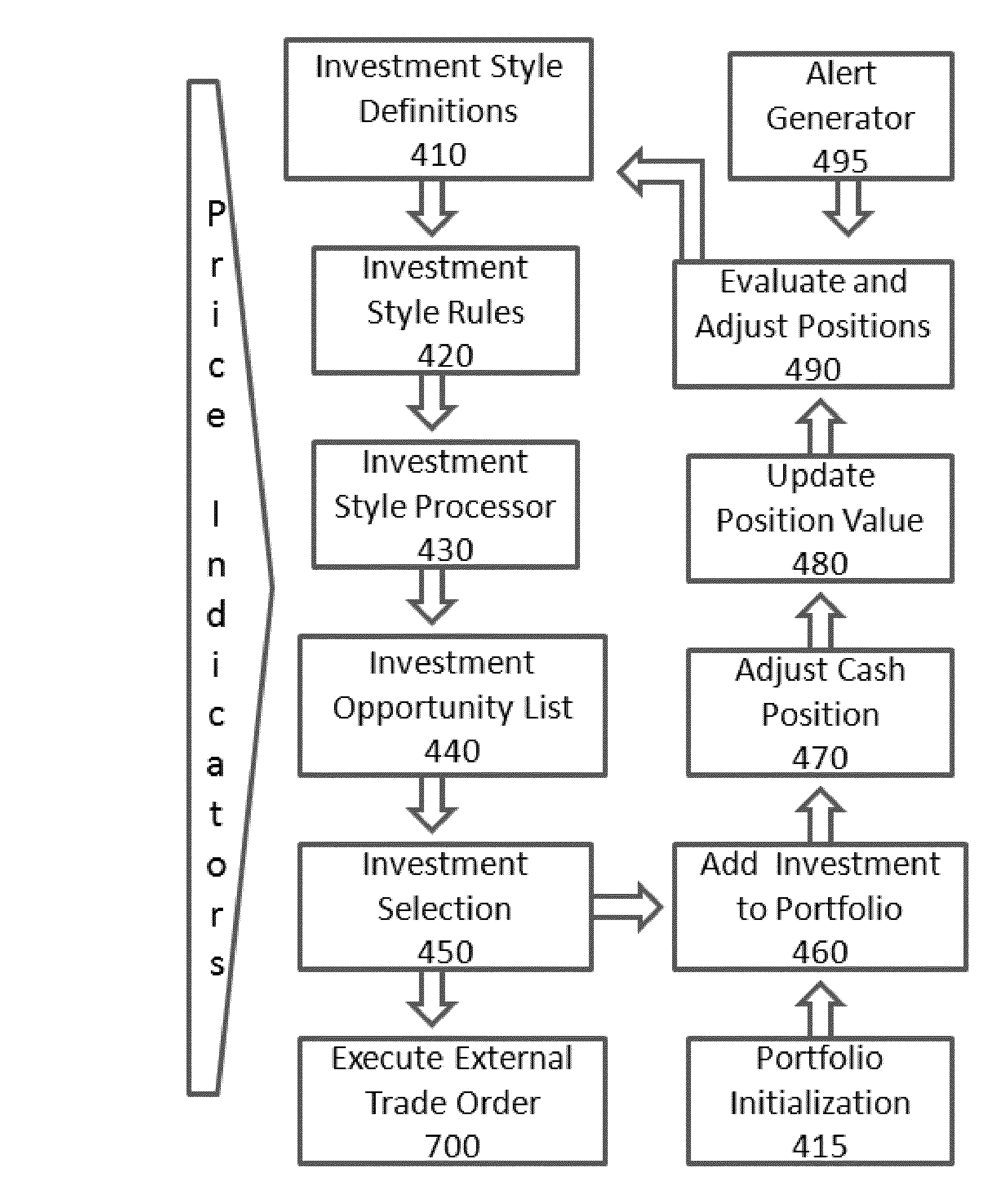

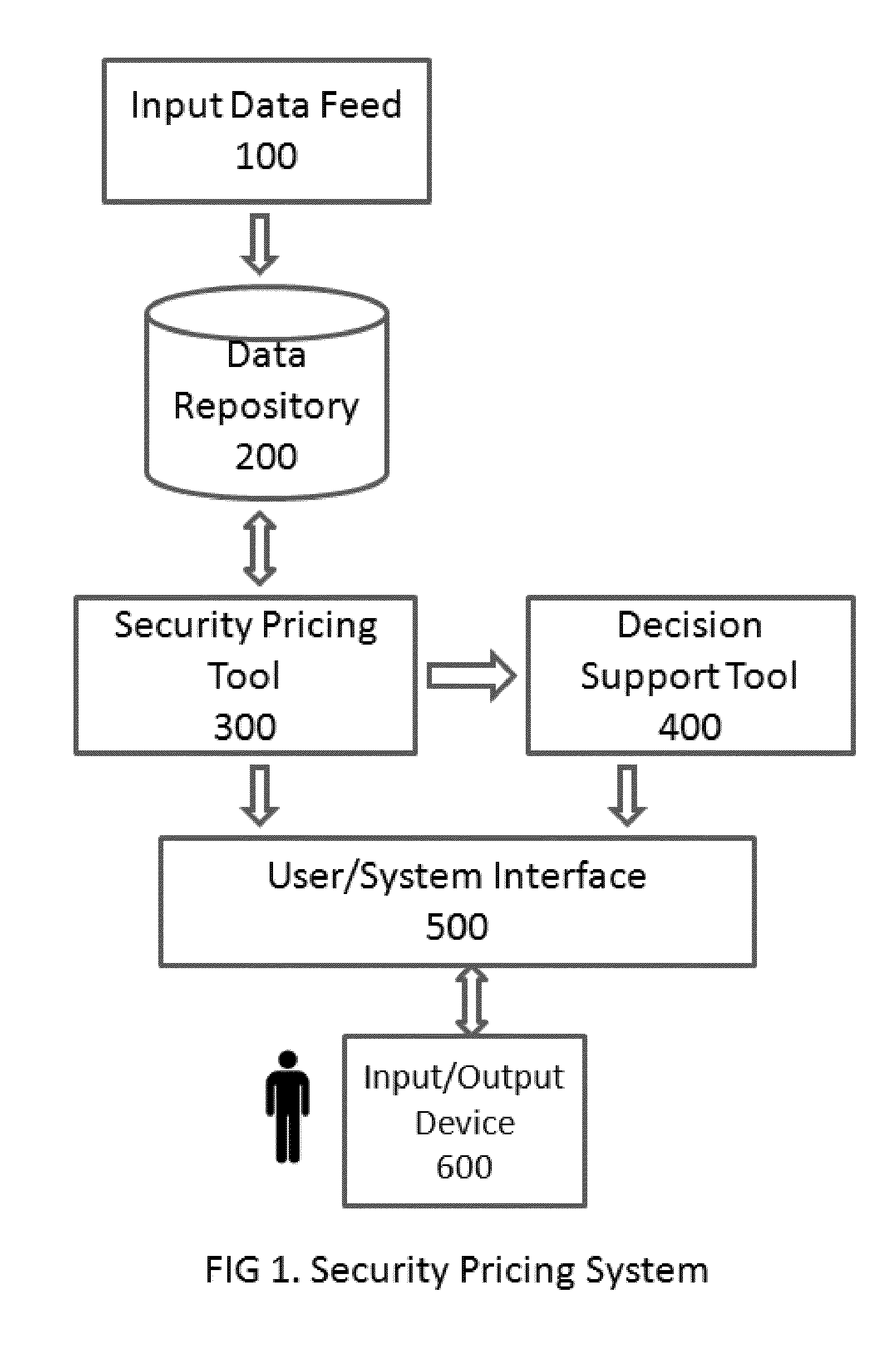

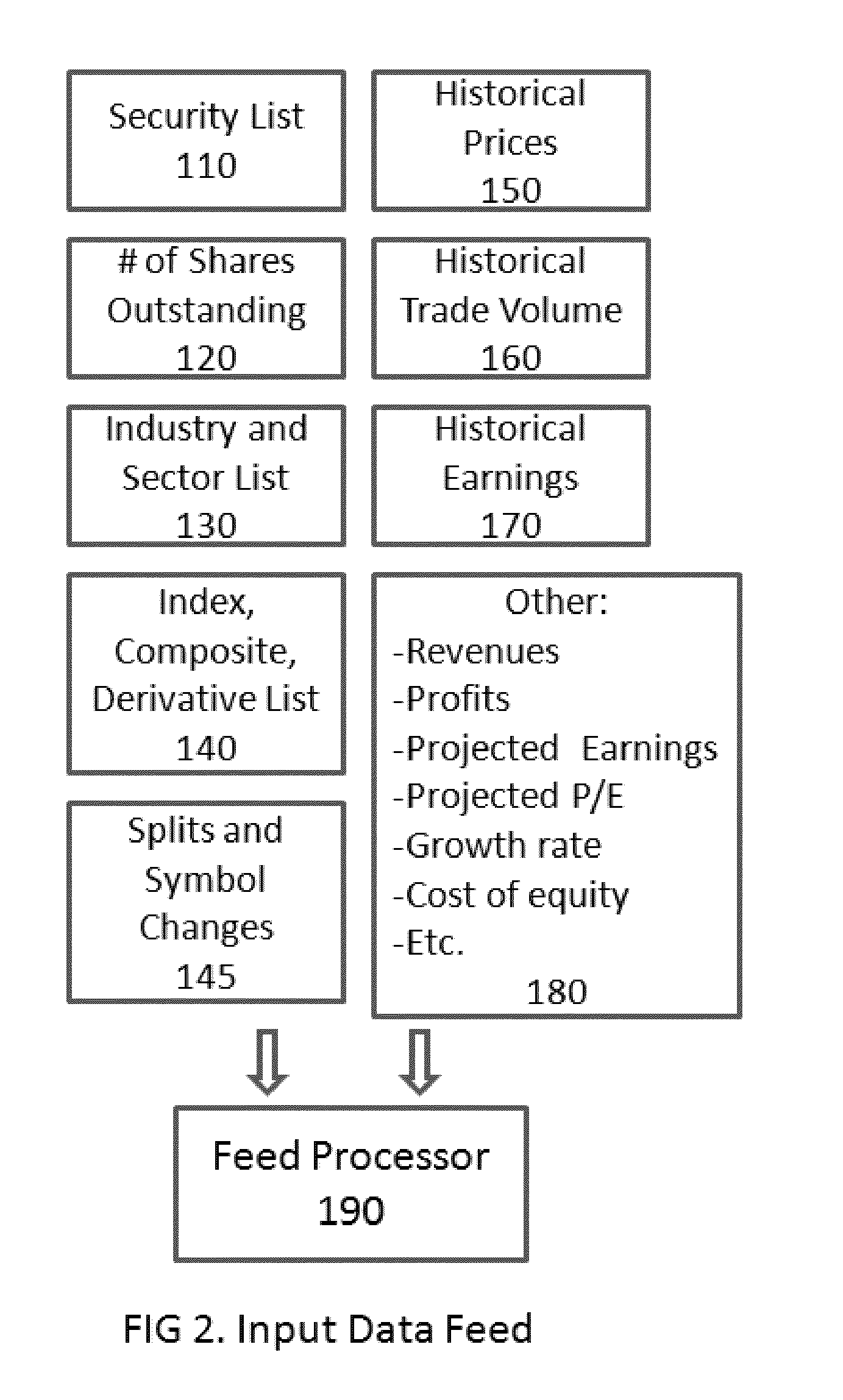

Security pricing method and system

The present invention includes a method and system implemented using a general-purpose computer known as Security Pricing System that generates target price and price indicators for traded securities such as stocks, bonds, and related indices, composites and derivative instruments. The method includes receiving historical data and optional forward-looking projected data related to securities, developing a security pricing model, and creating a security pricing tool that utilizes received historical data and the developed security pricing model to generate target price and price indicators. The target price can be used to evaluate expected gain / loss from holding a position in a security through comparison with current bid / ask prices. Price indicators such as price channel, divergence, support level, velocity, and momentum provide additional insight regarding the price spread and appreciation potential, direction and intensity of price movement, and investor sentiment. Price indicators can be used to identify, evaluate, analyze, and derive other conclusions or recommendations regarding security price and its investment potential. The system optionally includes a decision support tool for creating and managing an investment portfolio that uses the method and system of the present invention for defined investment objectives and styles.

Owner:DAYANIM JOSHUA FARZAD

Automated information technology management system

InactiveUS7865380B2Value maximizationError detection/correctionOffice automationArchitectural decisionSoftware

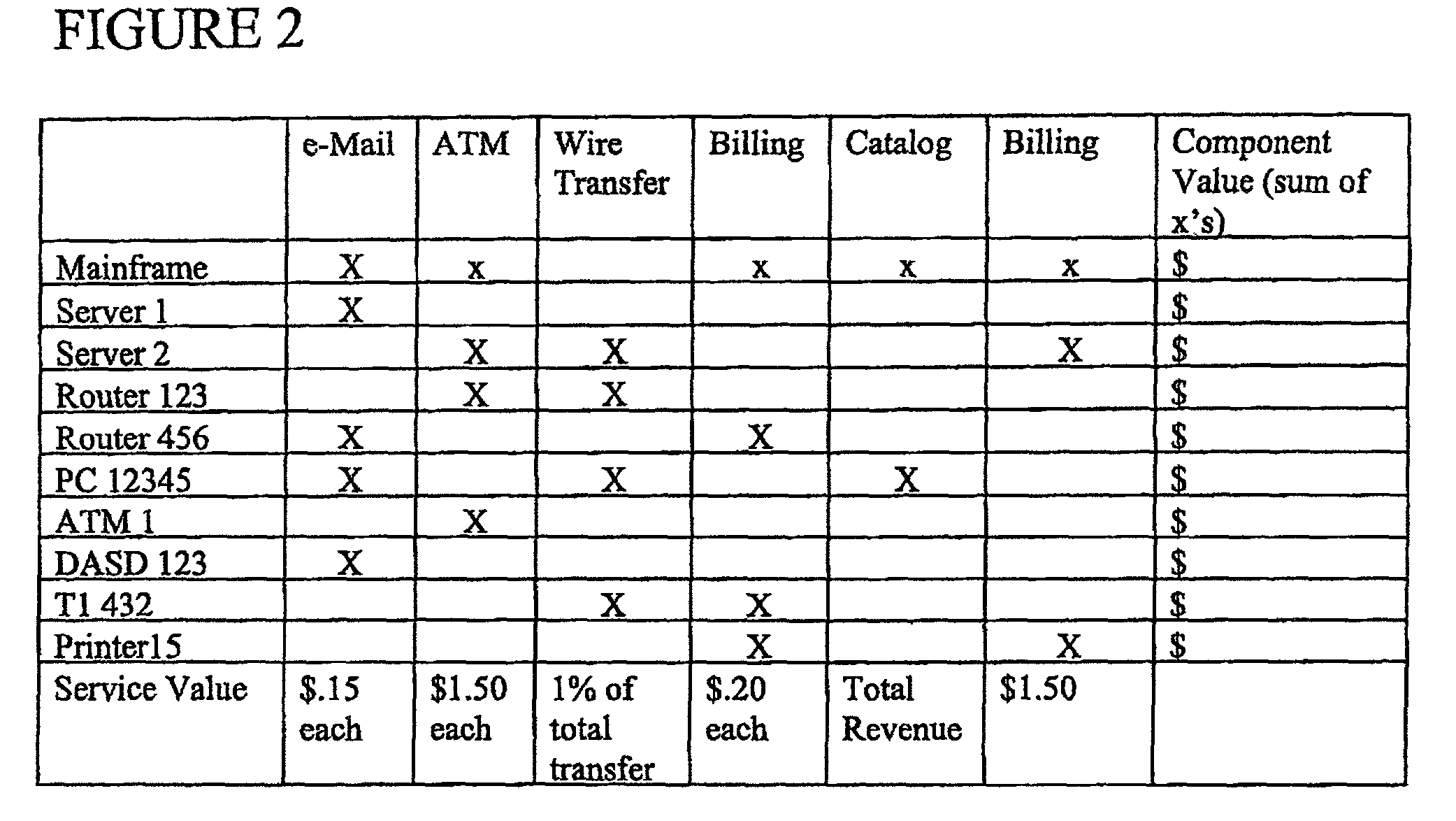

System and process for managing an IT infrastructure which collects transaction information on a component basis. The transaction data is used to evaluate the contribution of each component of the system as well as the business value of the service, and for the infrastructure as a whole. The usage data is prepared as reports and used in an IT management workflow model to make decisions about such things as the timing of system upgrades, strategic architectural decisions, timing of sunsetting of service components, both hardware and software, and the return-on-investment (ROI) valuation of IT investments. Component values may be assessed on either a volume (number of transactions) basis, or on the discrete dollar value of the transactions supported by the component.

Owner:IBM CORP

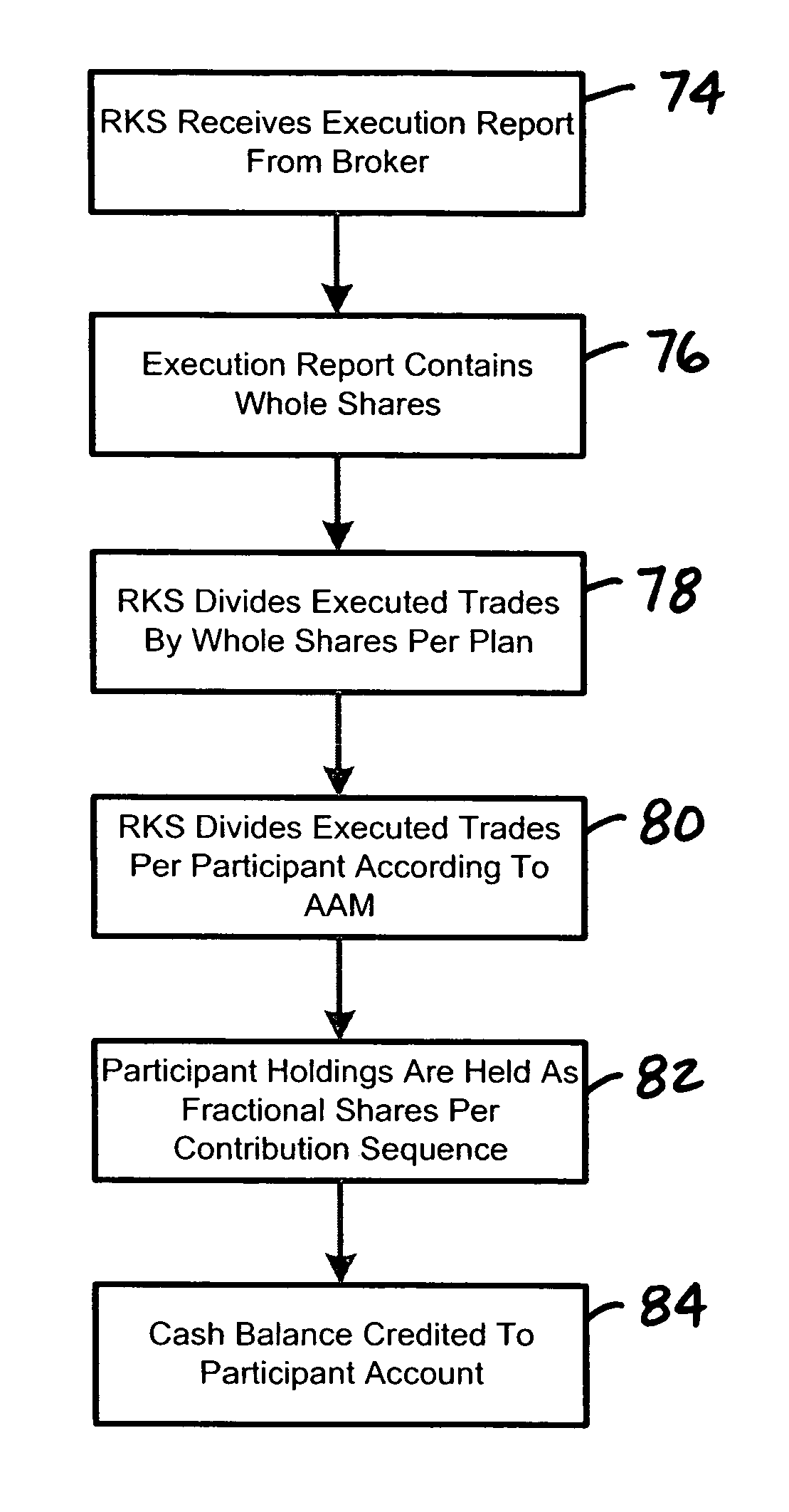

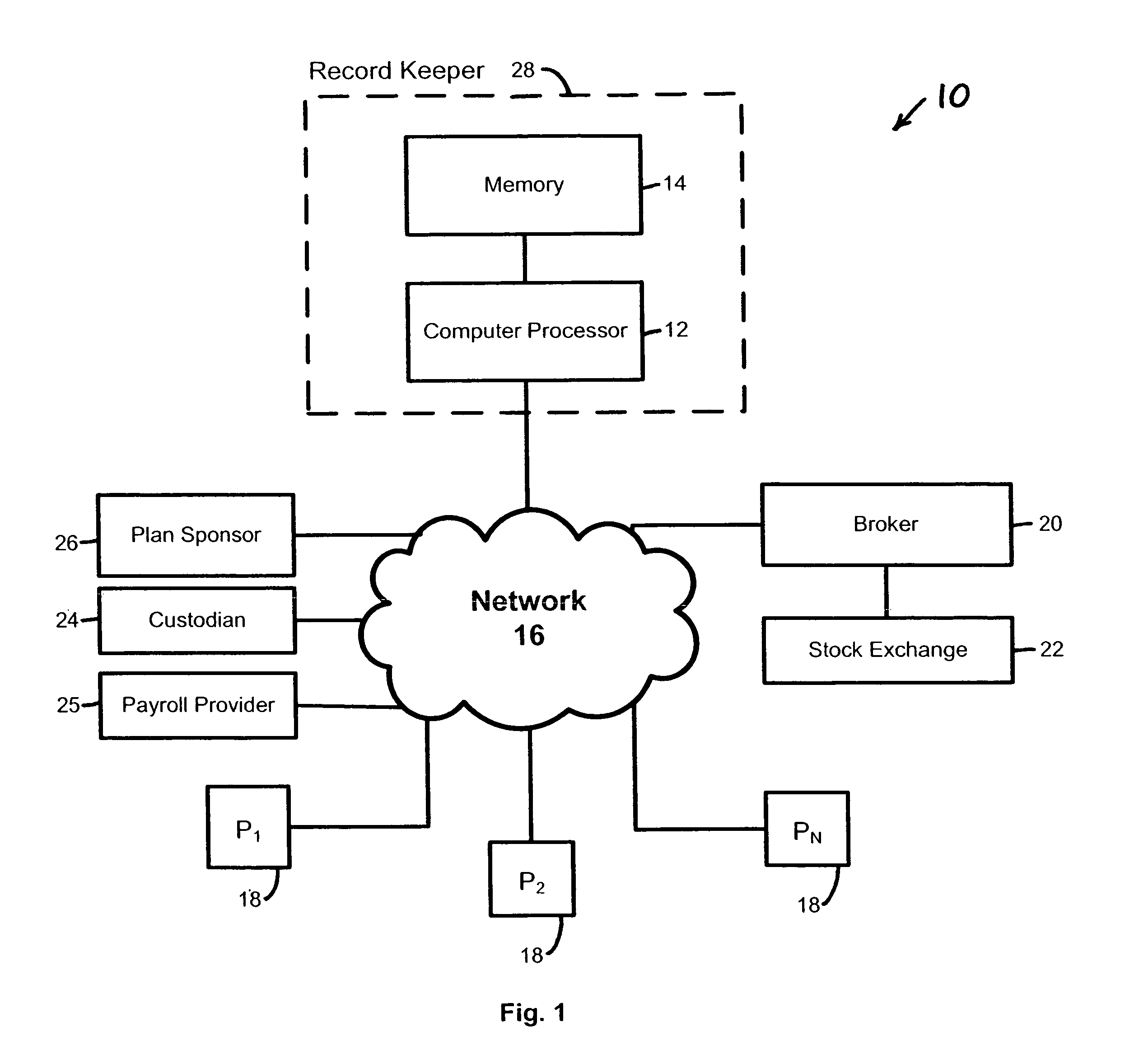

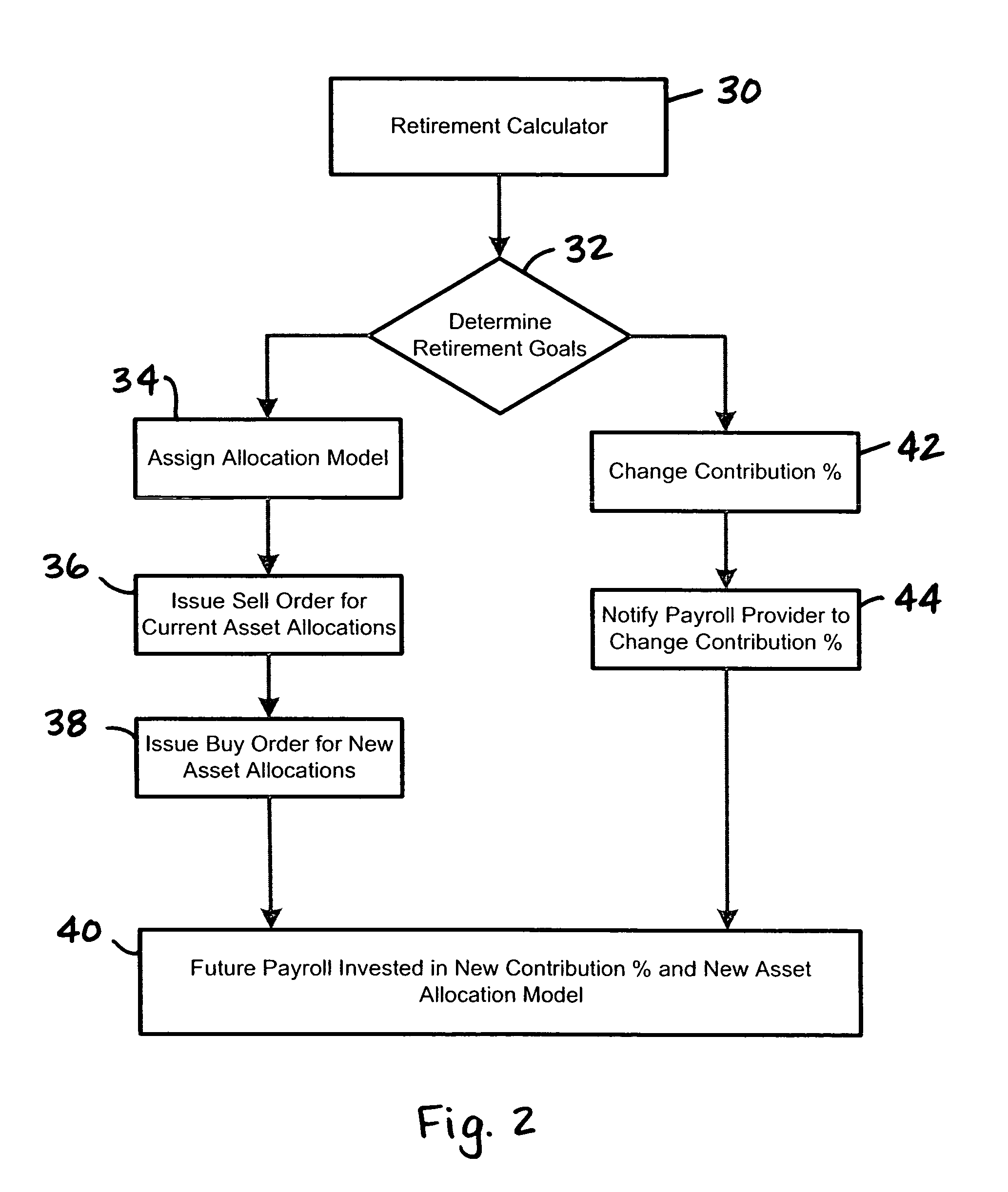

System and method for managing tax-deferred retirement accounts

A system and method of managing tax-deferred retirement accounts that enable the participants to invest in exchange traded funds (ETFs) and to forecast and intelligently plan for their retirement savings needs. The system and method preferably allow each participant to select an asset allocation model pursuant to which their investments will be managed and periodically rebalance the portfolio of each participant based on the selected asset allocation model.

Owner:INVEST N RETIRE

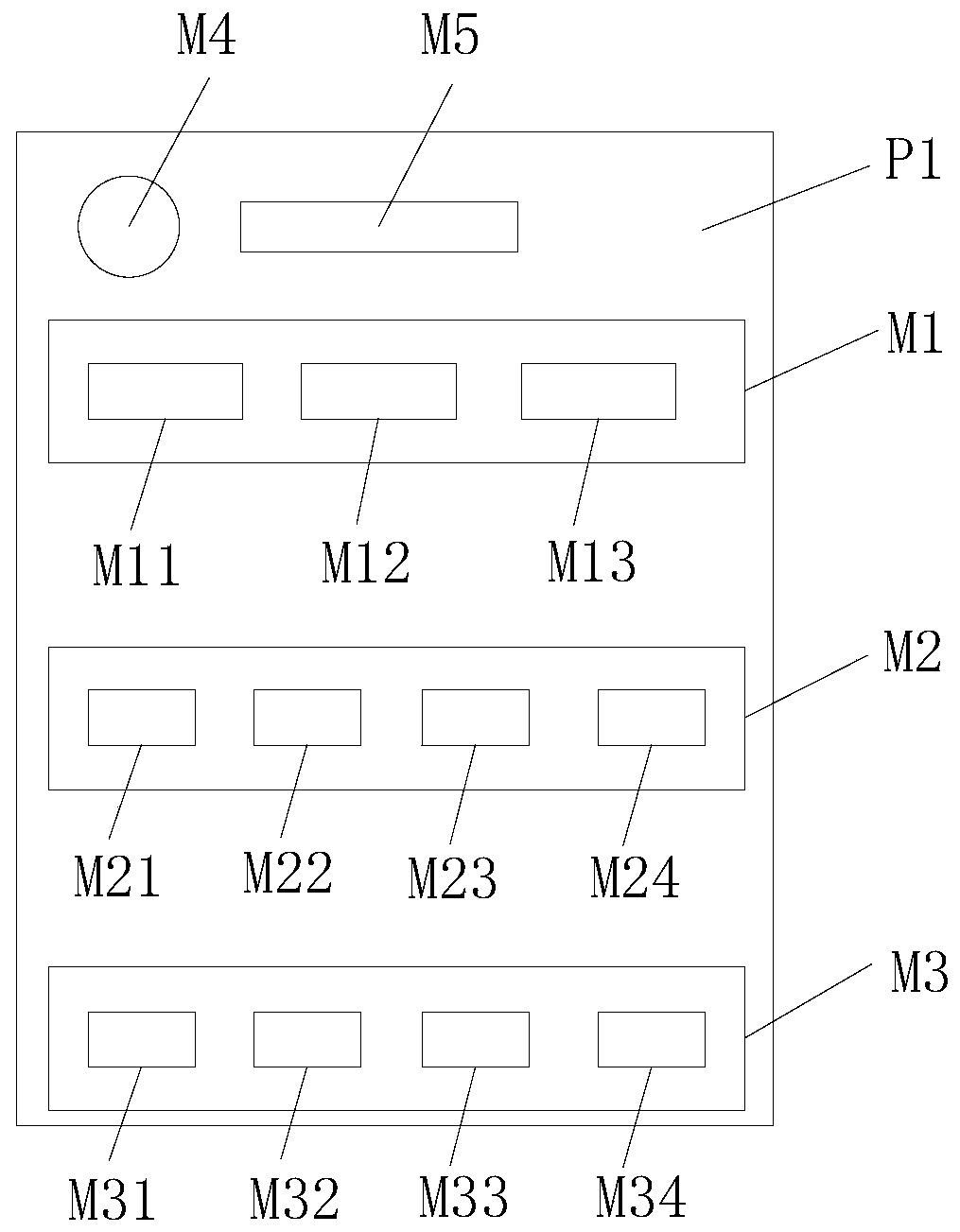

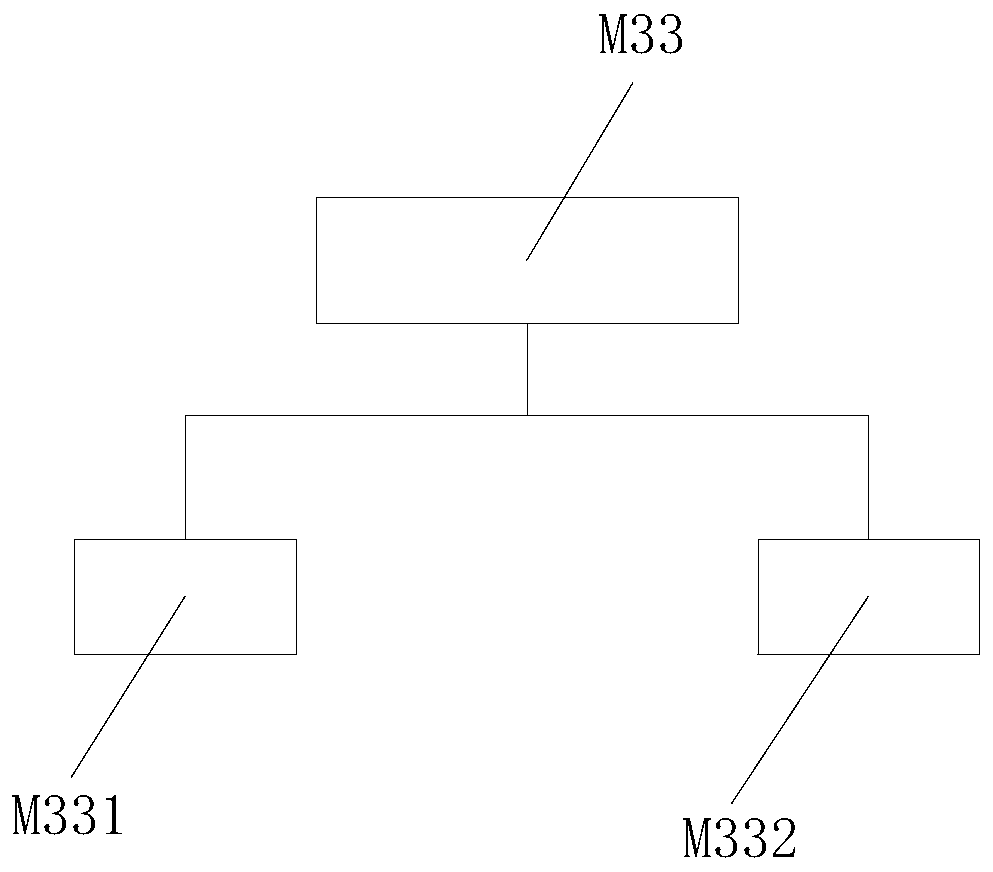

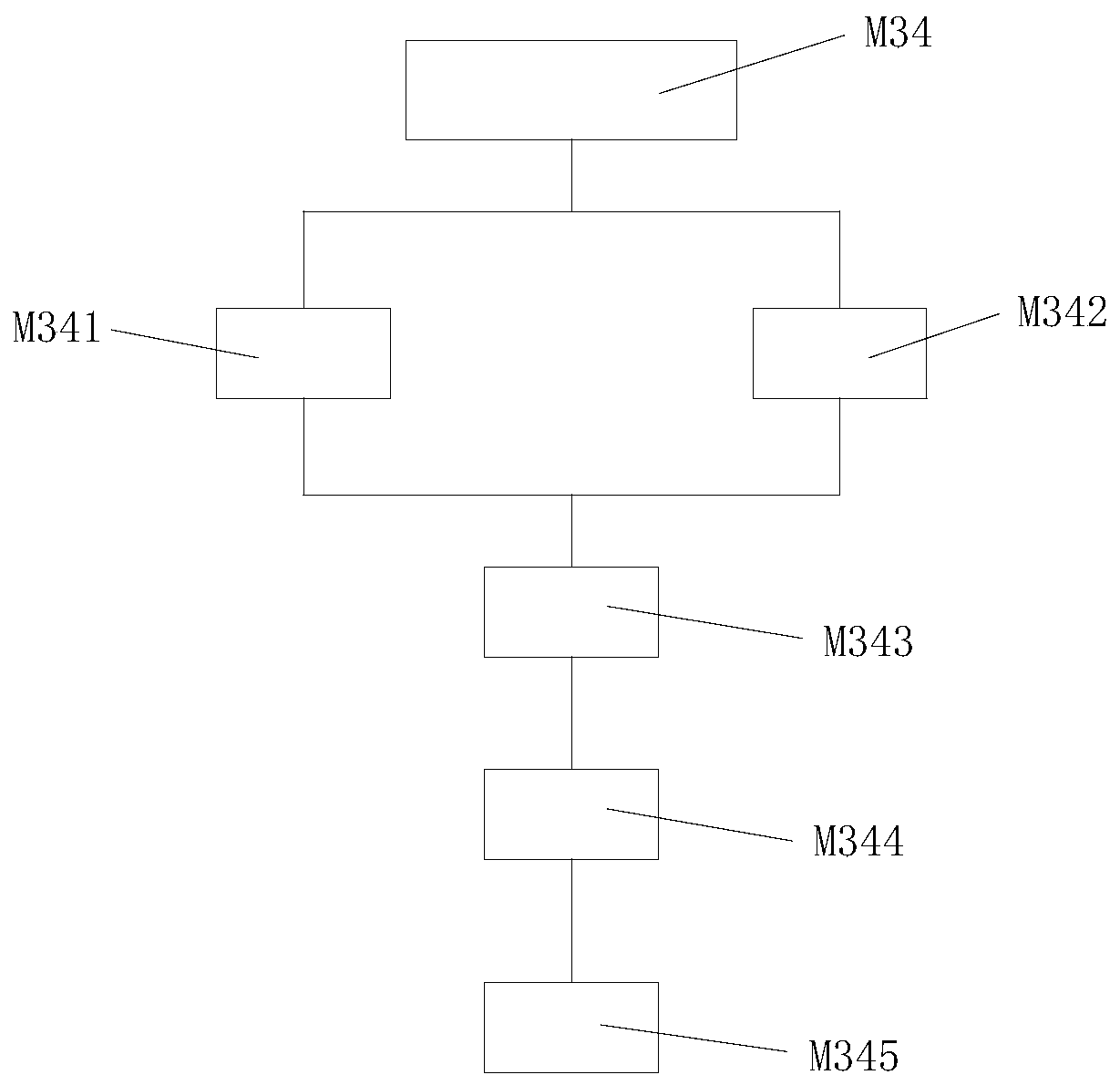

Live broadcast platform APP system

InactiveCN110633080ASolve the confusion of good and bad people, even low-level interest, and confusion of sources and channelsReduce the confusion of fish and dragons, even low-level interest, confusion of sources and channels, etc.Software designIt investmentComputer module

The invention provides a live broadcast platform APP system, and relates to the technical field of live broadcast APPs. The live broadcast platform APP system includes a main interface; a first main module is arranged at the position, close to the top, of the main interface. A second main module is arranged below the first main module; a third main module is arranged below the second main module;a my image and a search module are arranged above the first main module, and the my image is positioned on the left side of the search module; the first main module comprises road performance classification, my investment and my projects, after the road performance classification is clicked, an industry selection interface pops up, and after the industry is selected, a screen arranges all live broadcast of the selected industry according to the current popularity. Through reasonable planning of the field, the problems of fish and dragon mixing, even low-level interest, disordered source channels and the like of a live broadcast platform are greatly reduced, and the video can be published and uploaded only through real name and industry authentication after user registration.

Owner:安徽金博略文化产业有限责任公司

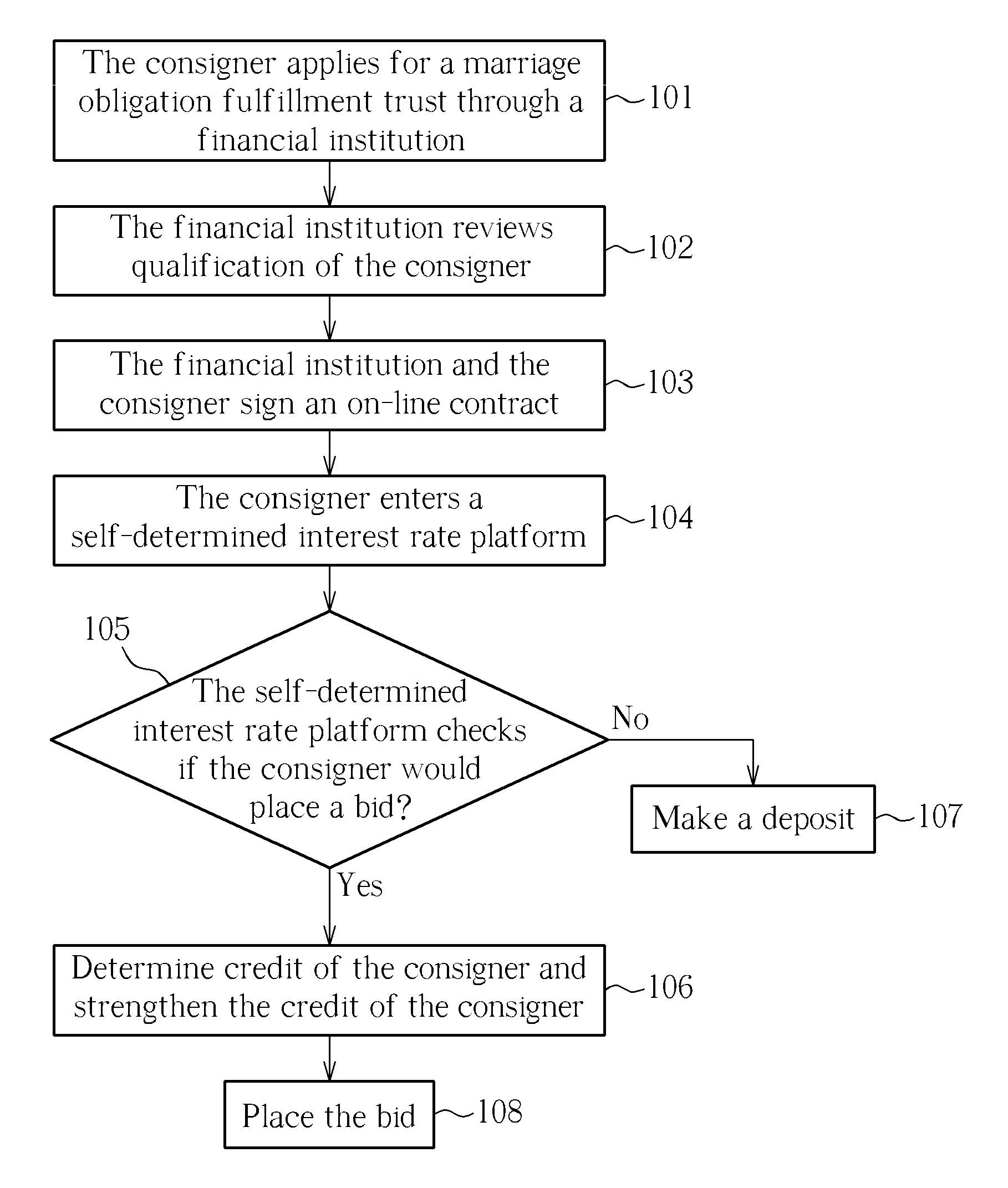

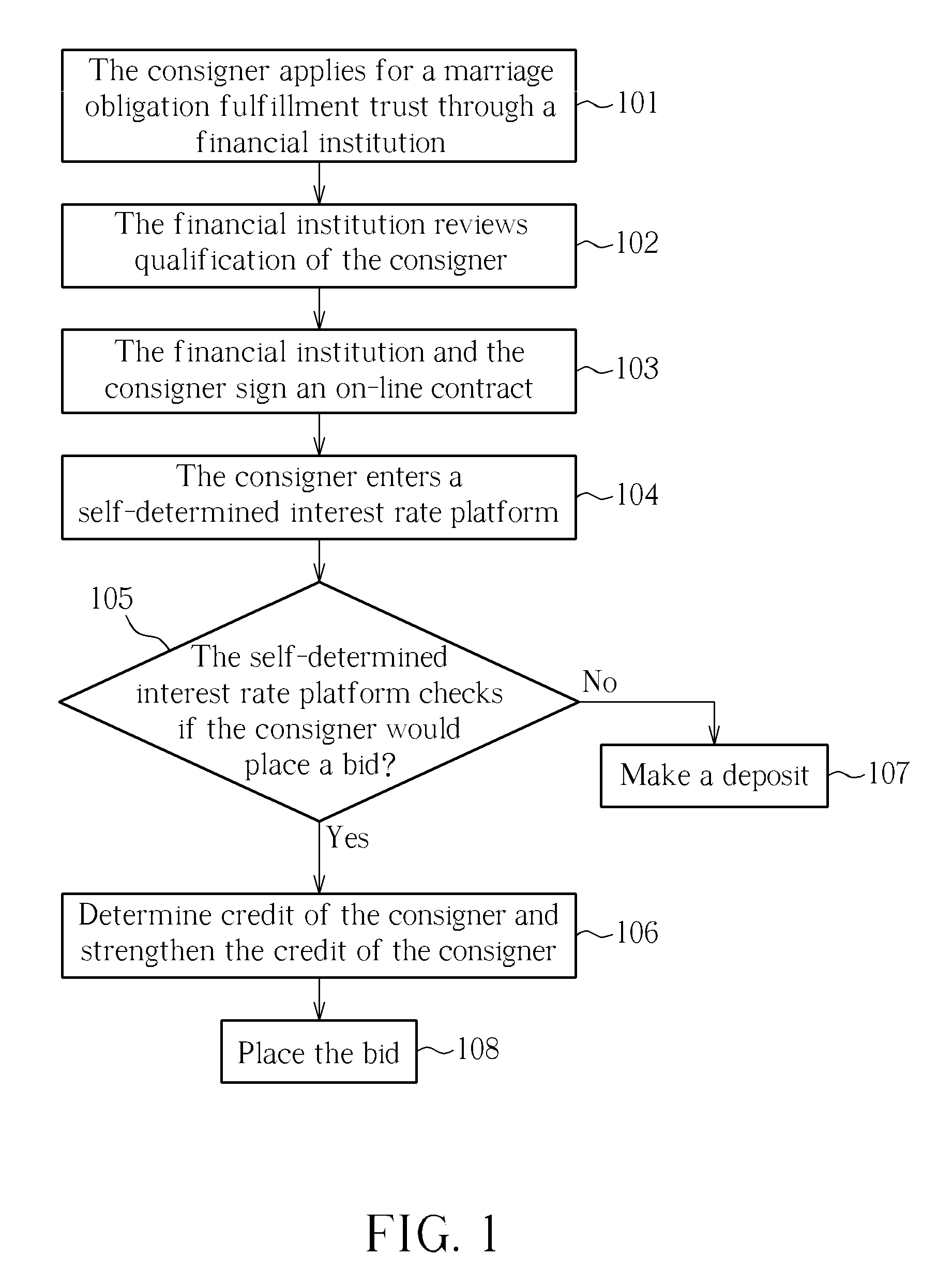

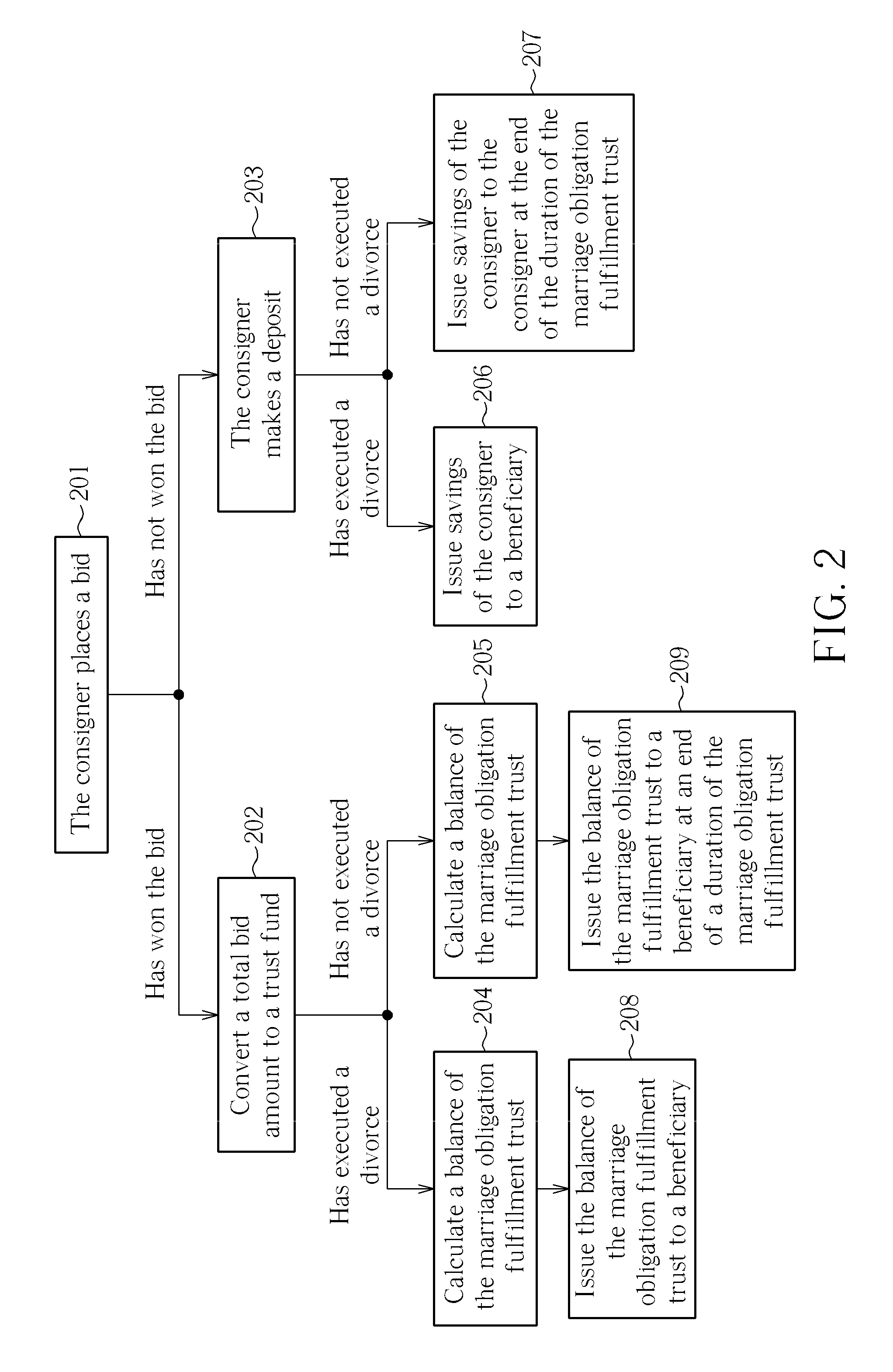

Marriage Obligation Fulfillment Trust Method and System

Owner:SHACOM COM

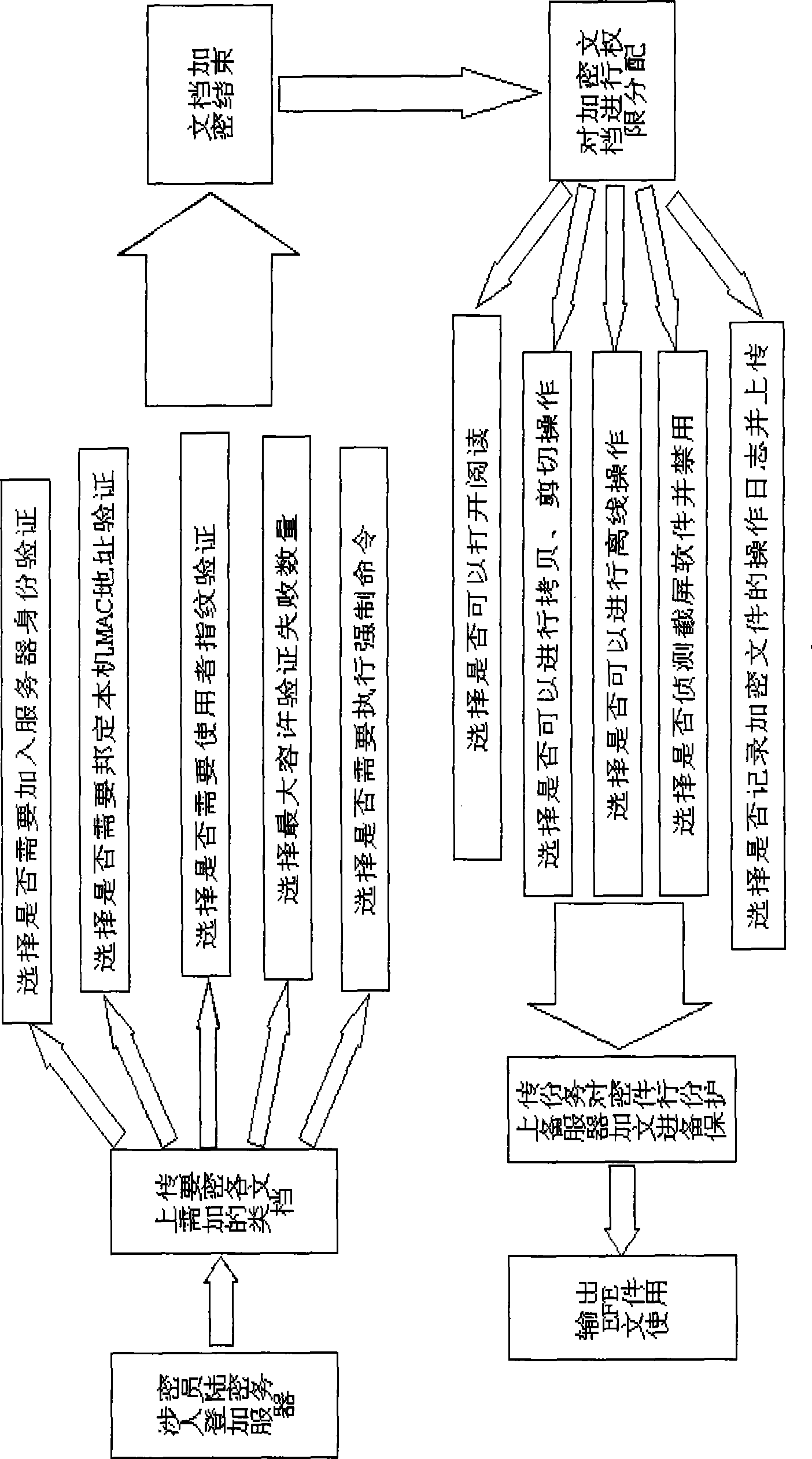

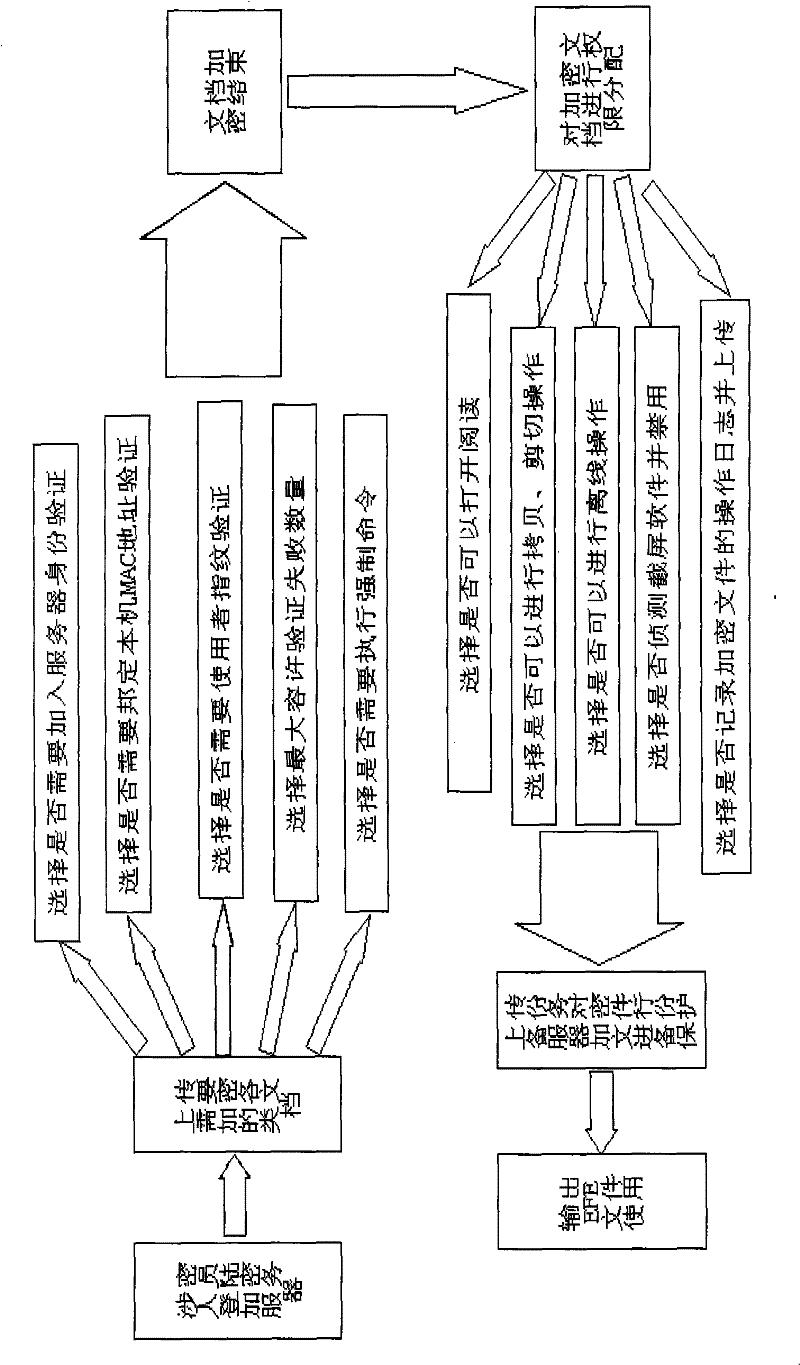

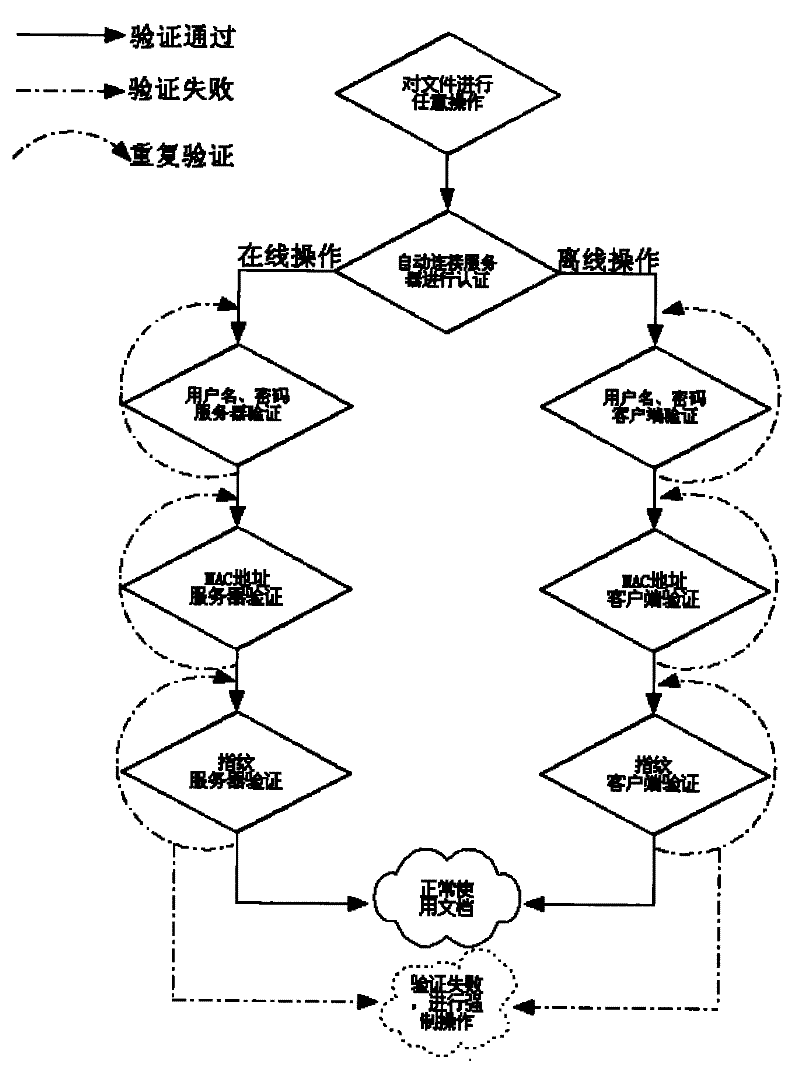

Method for guarantee safety of electronic file

InactiveCN101364984BImprove protectionLow costUser identity/authority verificationDigital data authenticationElectronic documentIt investment

The invention relates to a method for ensuring the safety of an electronic file, which comprises an encryption process and a decryption process. The passive protection technology is embedded on the basis of active encryption, so that the control of tissues to the electronic file can be kept outside a fire wall; the use strategy of the file is managed in a dynamic manner to extend the value of prior IT investment to the outer part of safety control and content management system, thereby reducing the cost of sharing information among customers, supplier, cooperative partners and other relevant parties.

Owner:XIAN DINGLAN COMM TECH

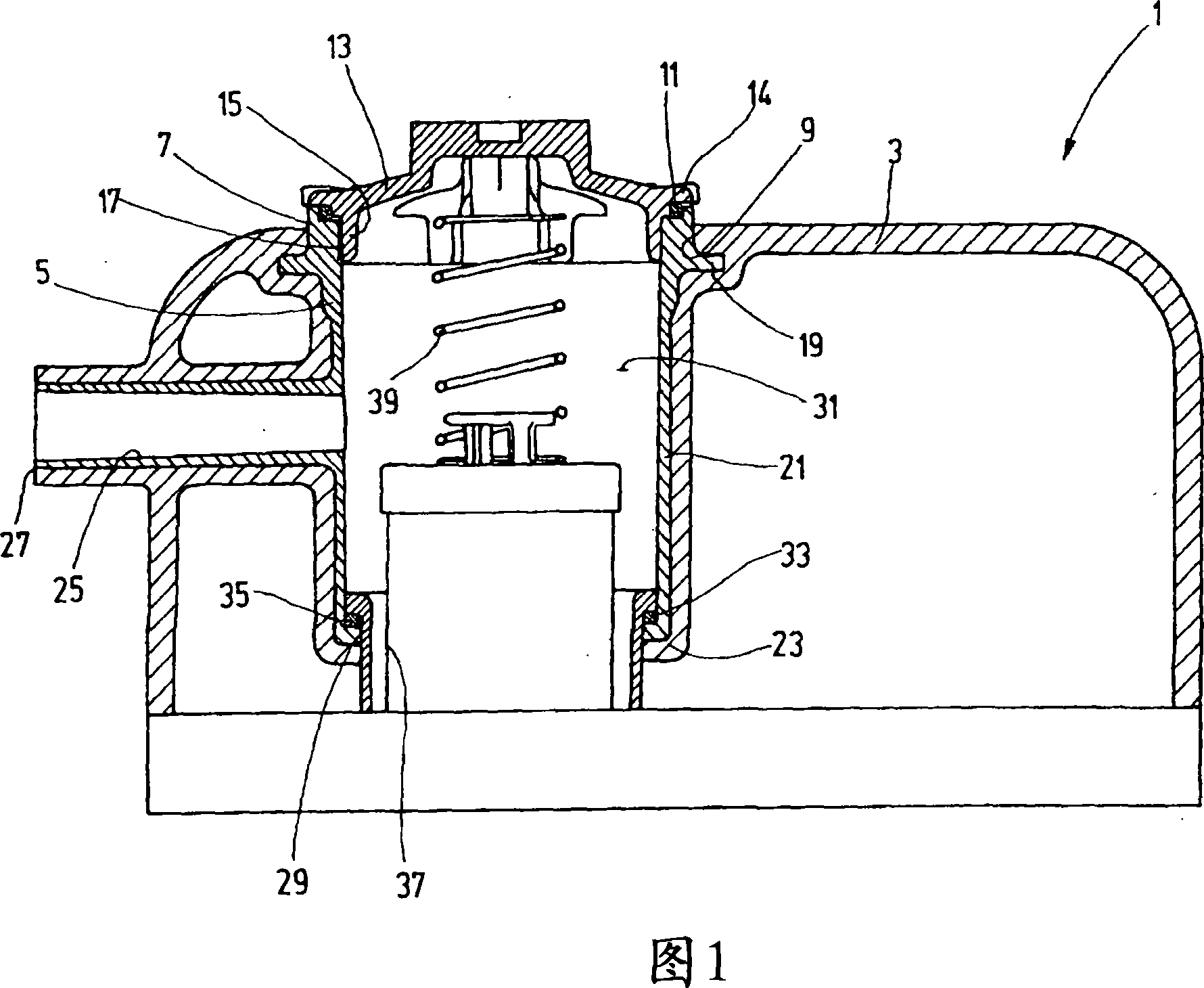

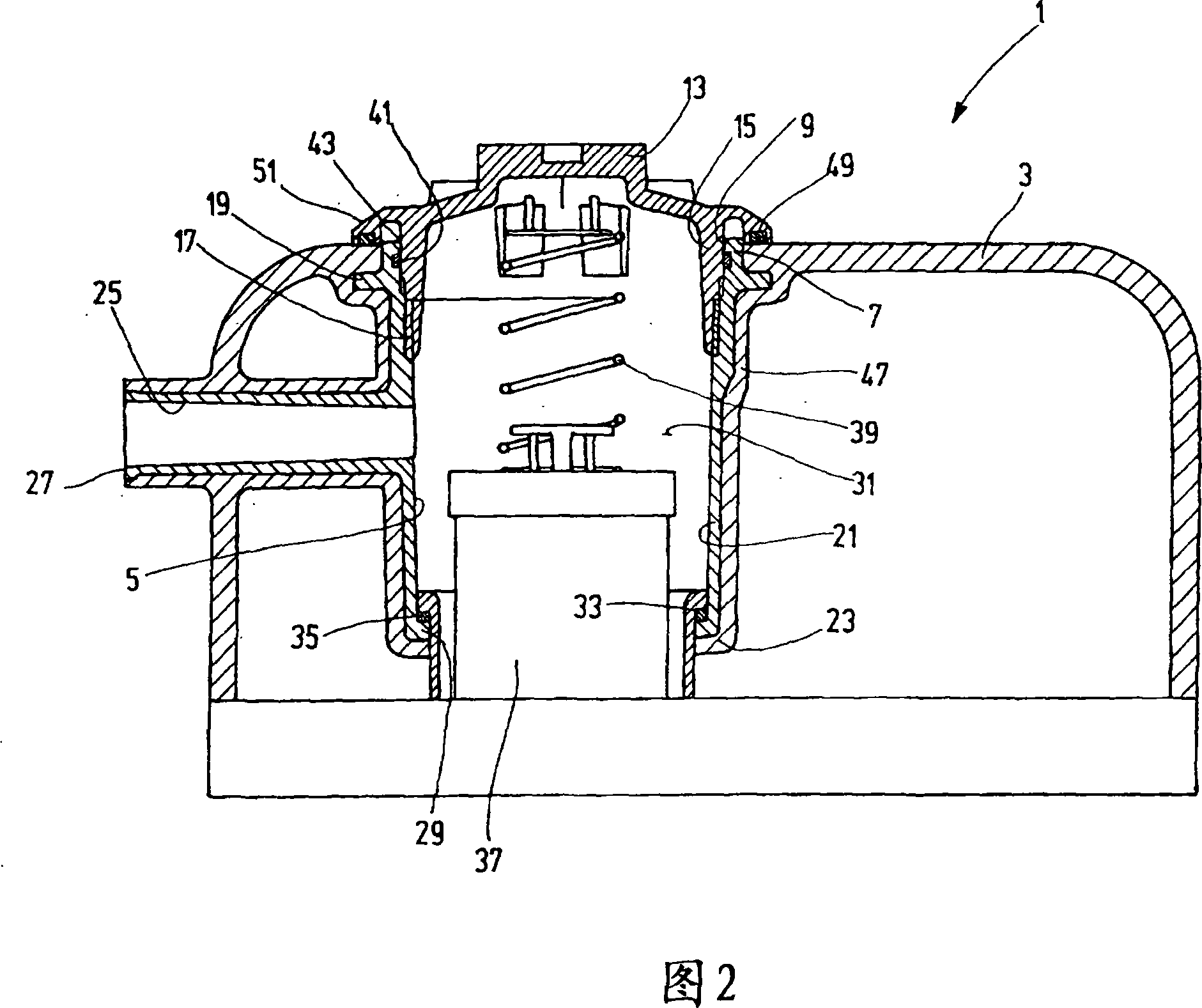

Fitting for forming a fluid-conducting connection

ActiveCN101061342AFirmly connectedAvoid deformationMembrane filtersBranching pipesIt investmentSoftware system

Owner:HYDAC FILTERTECHNIK GMBH

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com