Patents

Literature

69 results about "Investment planning" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

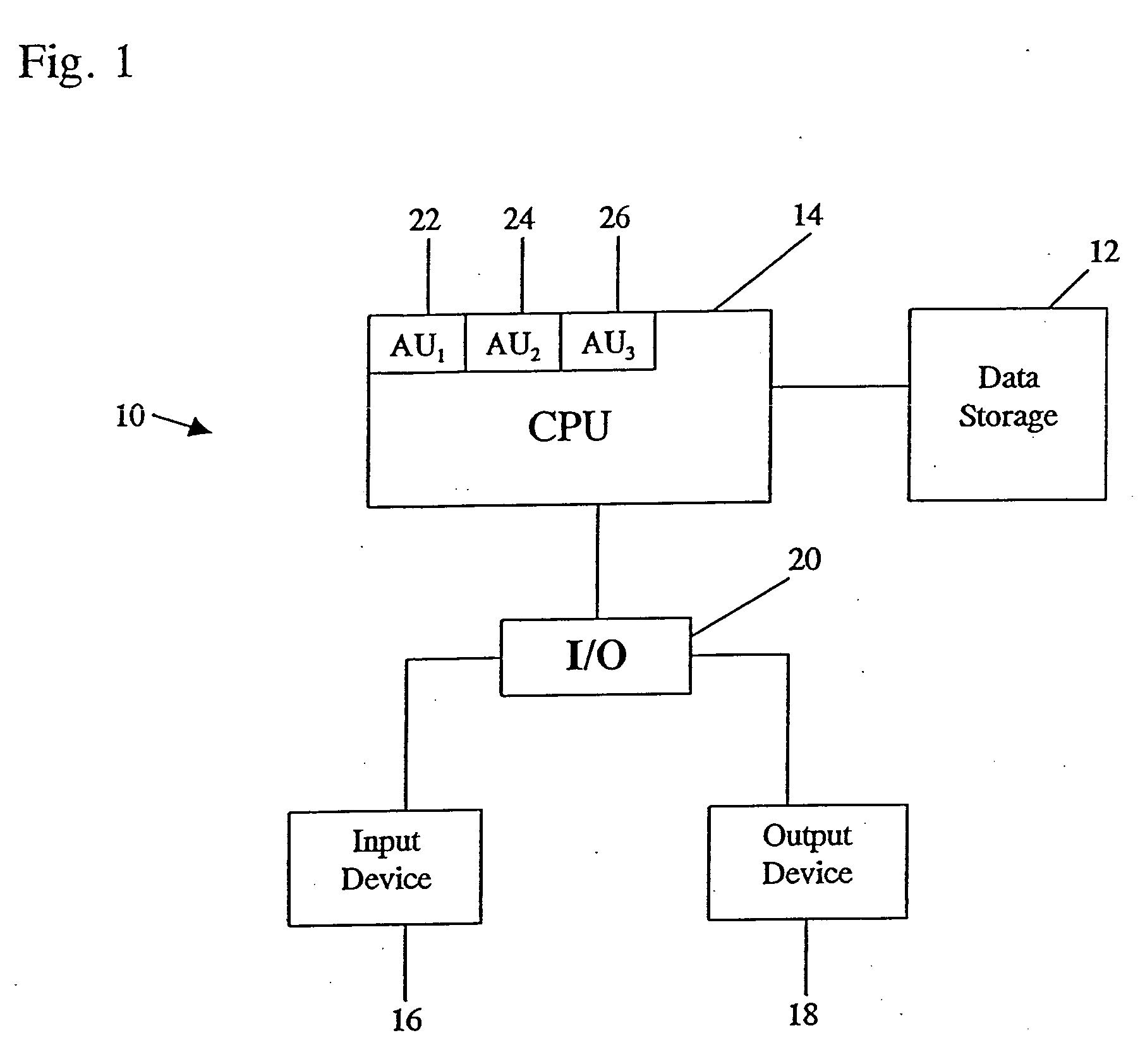

System and method for automating investment planning

InactiveUS7149713B2Minimizes tax impact and transaction costFinanceFinancial transactionFinancial trading

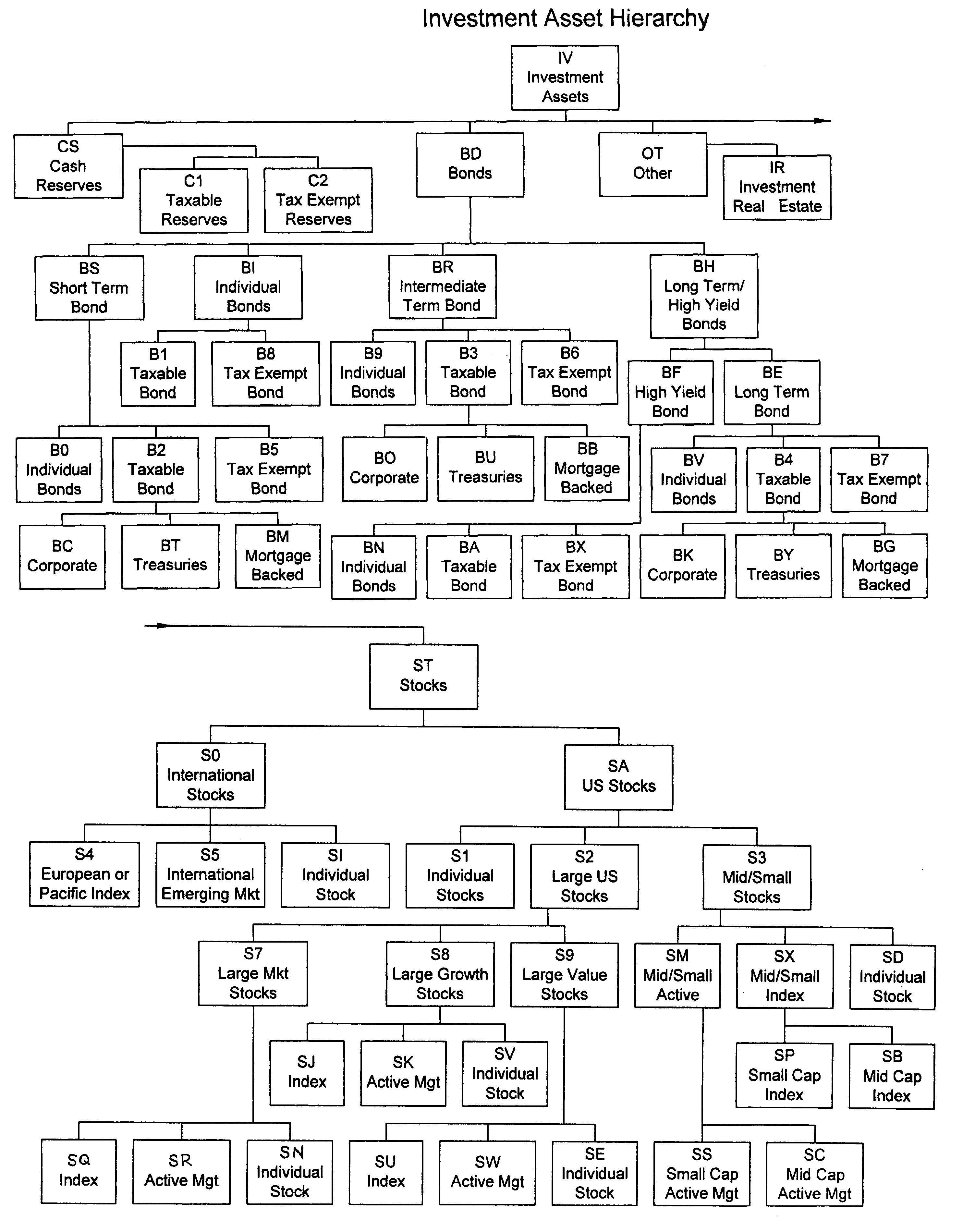

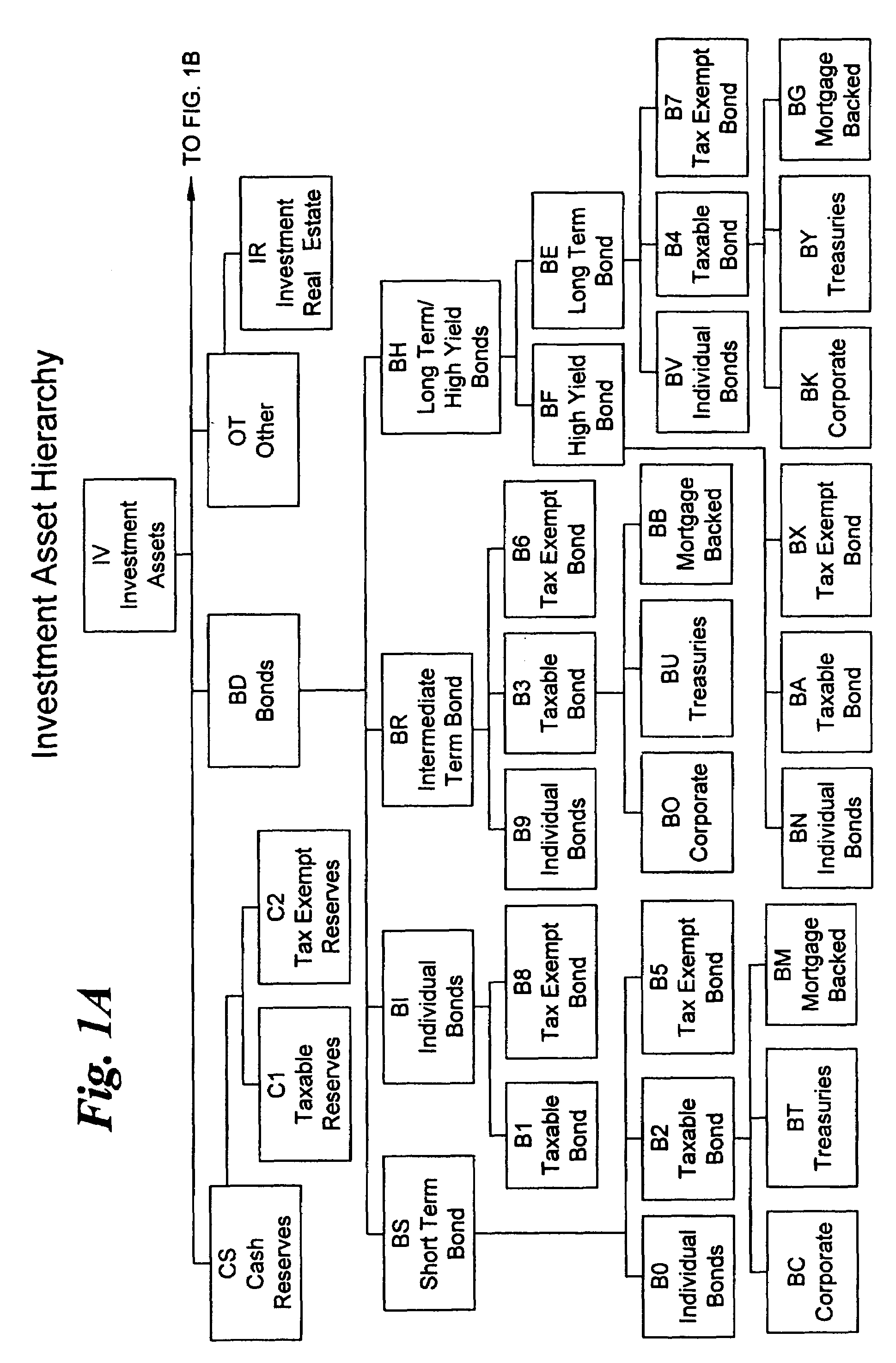

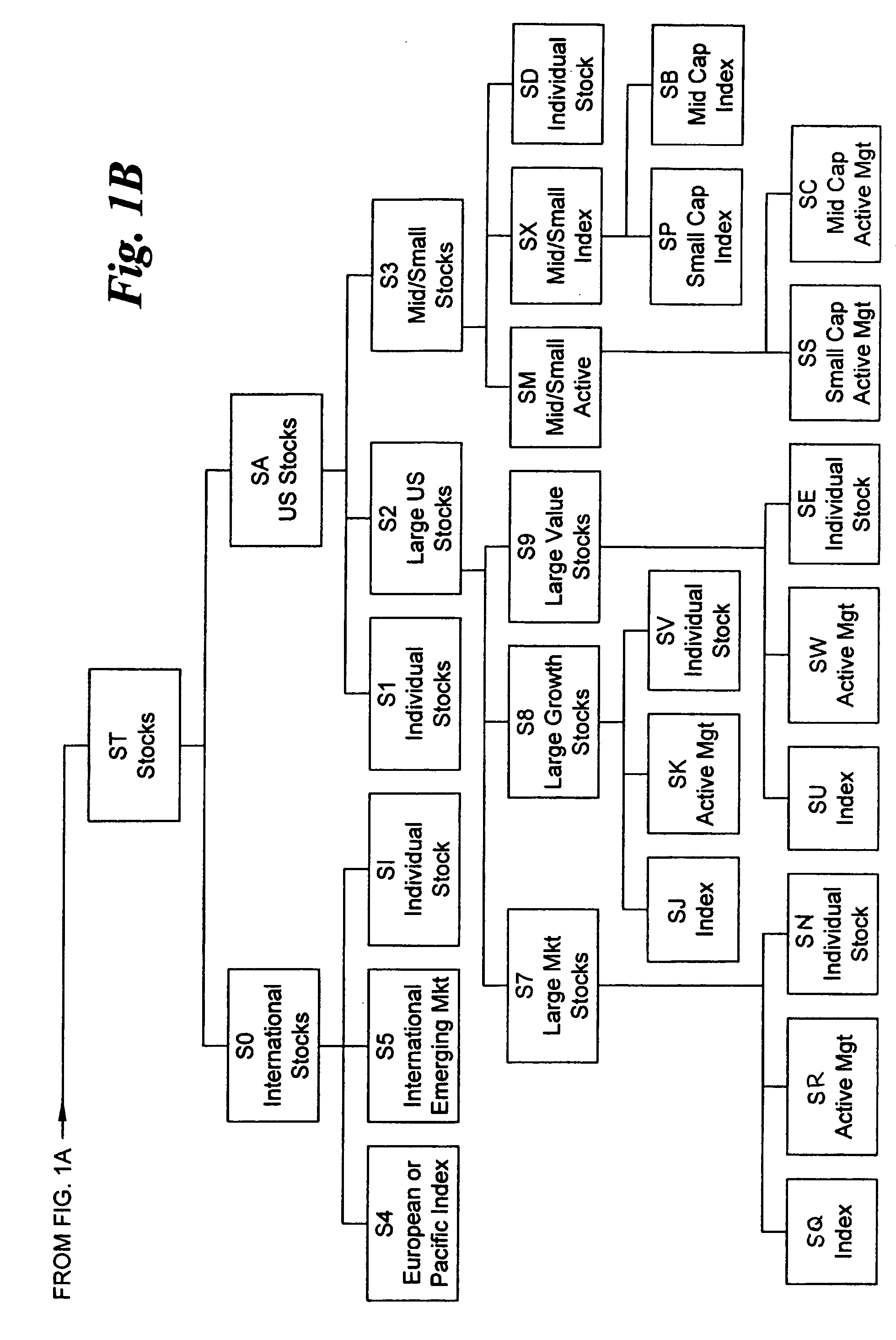

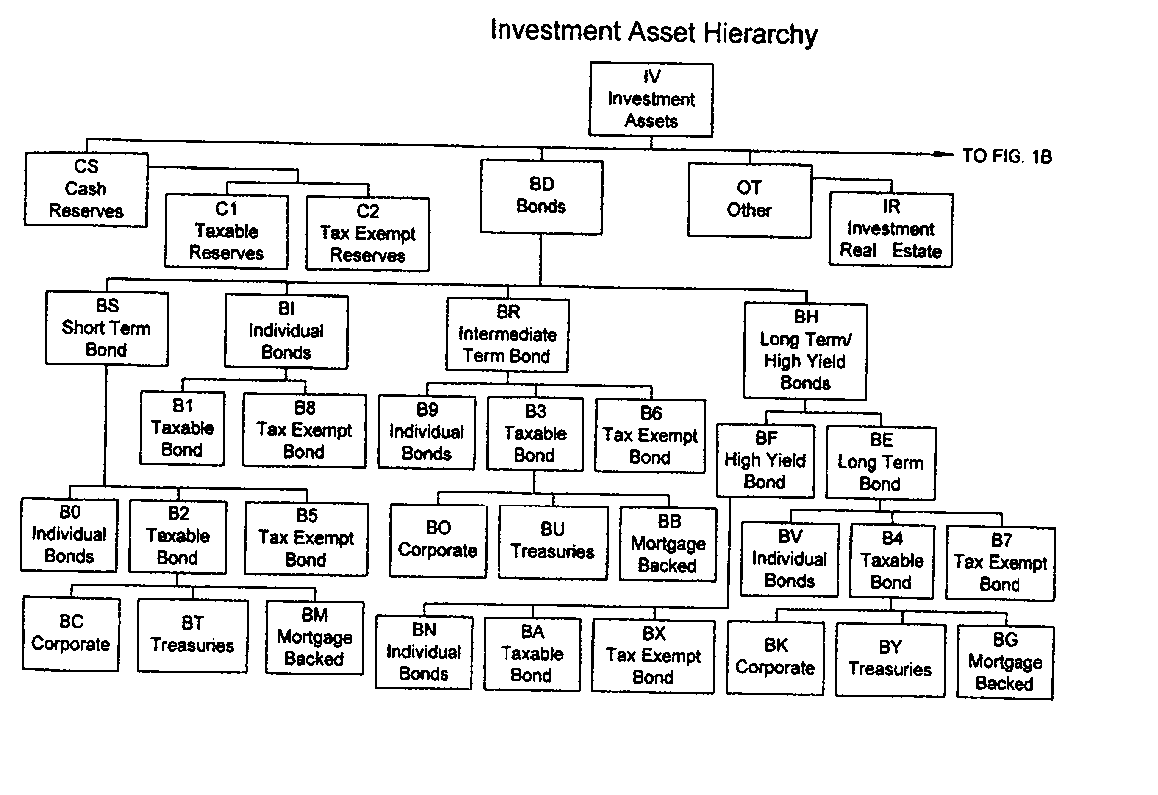

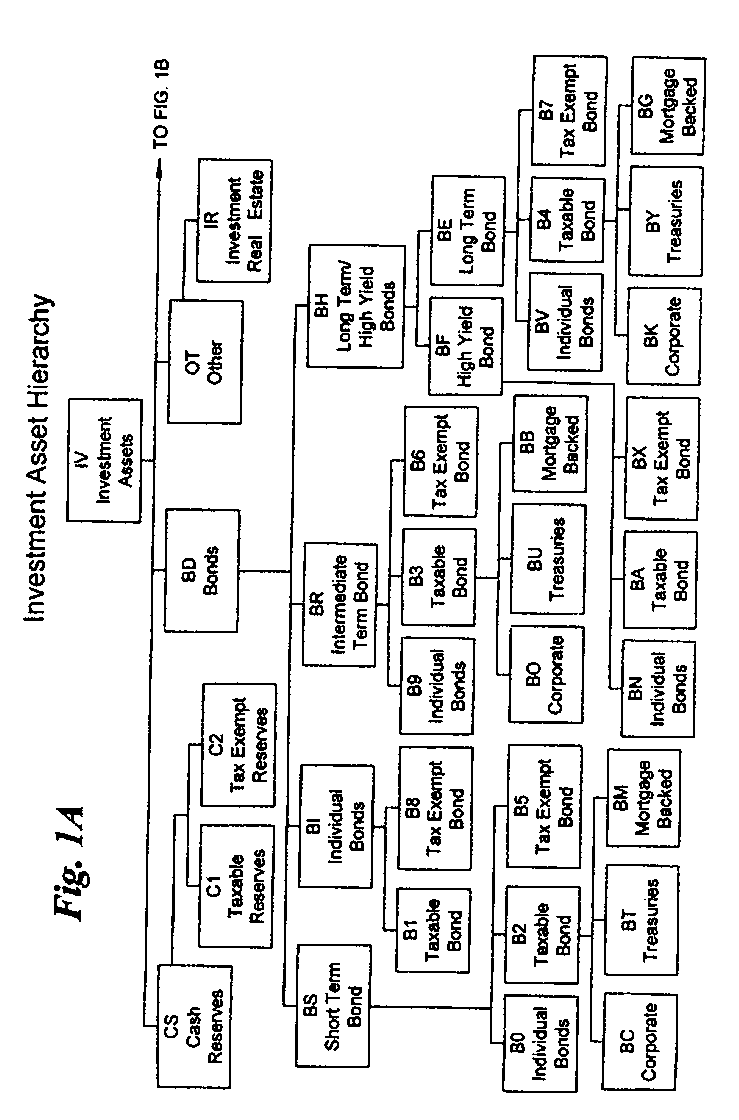

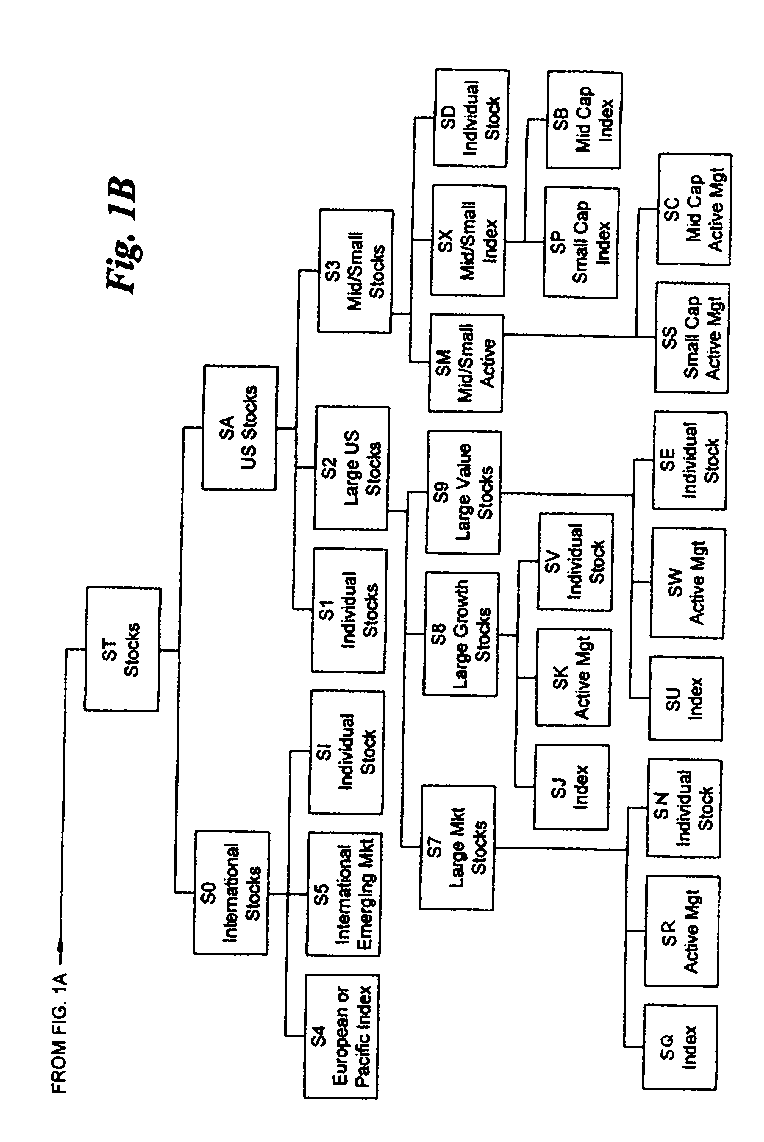

A computerized scheme automates investment planning for a client. In the scheme, data regarding the client's desired asset allocation, current asset portfolio and preferred domain are input into a computer or processor. This data are used to automatically generate financial transaction recommendations for modifying the client's current asset portfolio to reach as close as possible to the desired asset allocation and the preferred domain. The recommendations include specific recommendations for selling amounts of selected current assets and specific recommendations for buying amounts of one or more investment funds. The recommendations are displayed on a summary report for review by the client or the client's financial manager, or the recommendations are electronically communicated to a trade execution computer which automatically performs the necessary transactions to execute the buy / sell recommendations. The recommendations are selected in a manner which minimizes the tax impacts and transaction costs of potential sell transactions.

Owner:THE VANGUARD GROUP

System and Method for Automatic Investment Planning

InactiveUS20050154658A1Minimizes tax impactReduce transaction costsFinanceSpecial data processing applicationsProgram planningFinancial transaction

Abstract of the DisclosureA computerized scheme automates investment planning for a client. In the scheme, data regarding the client's desired asset allocation, current asset portfolio and preferred domain are input into a computer or processor. This data are used to automatically generate financial transaction recommendations for modifying the client's current asset portfolio to reach as close as possible to the desired asset allocation and the preferred domain. The recommendations include specific recommendations for selling amounts of selected current assets and specific recommendations for buying amounts of one or more investment funds. The recommendations are displayed on a summary report for review by the client or the client's financial manager, or the recommendations are electronically communicated to a trade execution computer which automatically performs the necessary transactions to execute the buy / sell recommendations. The recommendations are selected in a manner which minimizes the tax impacts and transaction costs of potential sell transactions.

Owner:THE VANGUARD GROUP

User interface for a financial modeling system

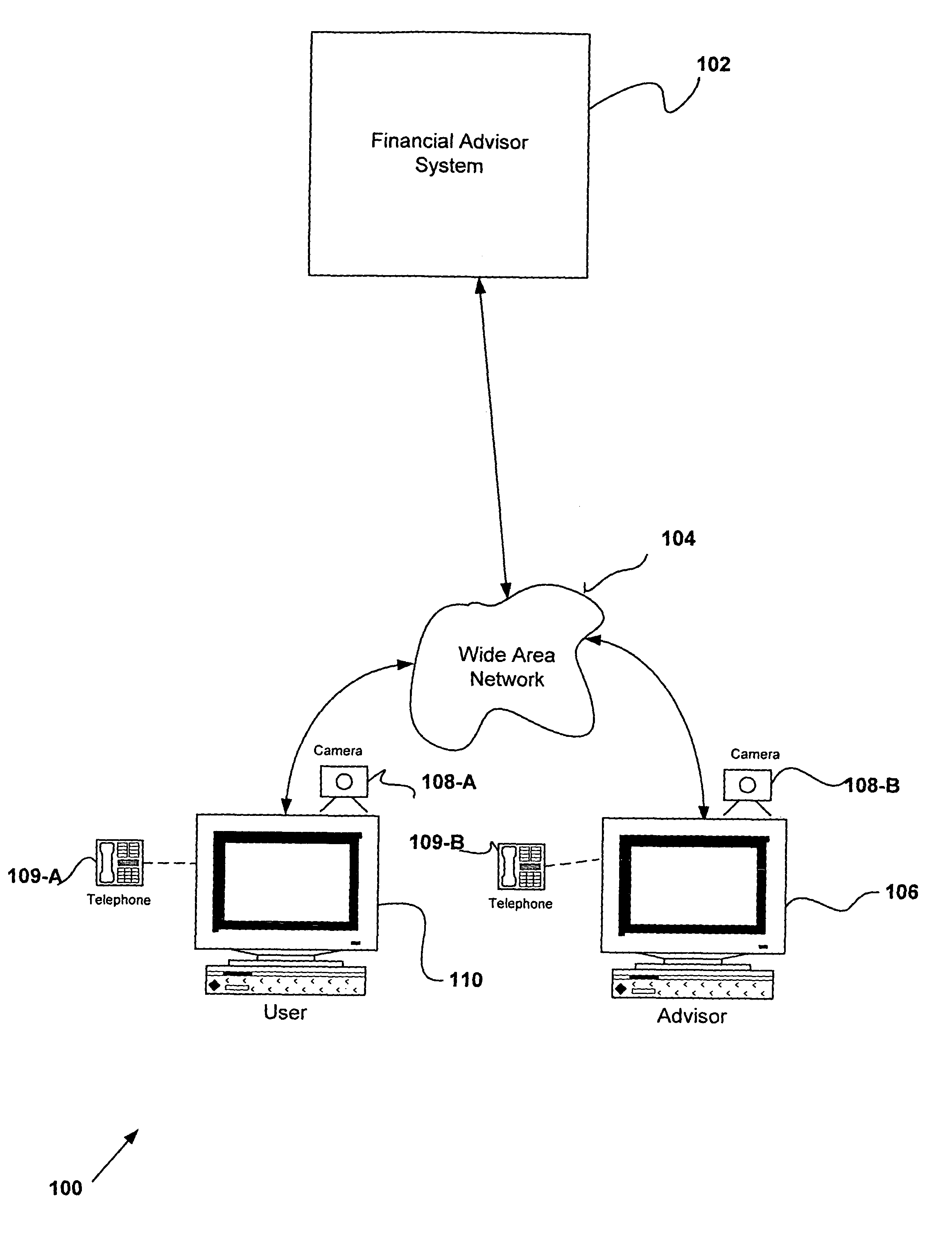

The present invention is a graphical user interface within the context of a financial planning and management system and method. The model consists of a user intention modeling module and an investment planning module. The graphical user interface displays a model and many of its related characteristics simultaneously and allows the user to interactively manipulate the model by selecting various function and mode icons. Furthermore, the user may accesses both a live advisor and an automated coach through the graphical user interface by selecting one of several communication icons.

Owner:ACCENTURE GLOBAL SERVICES LTD

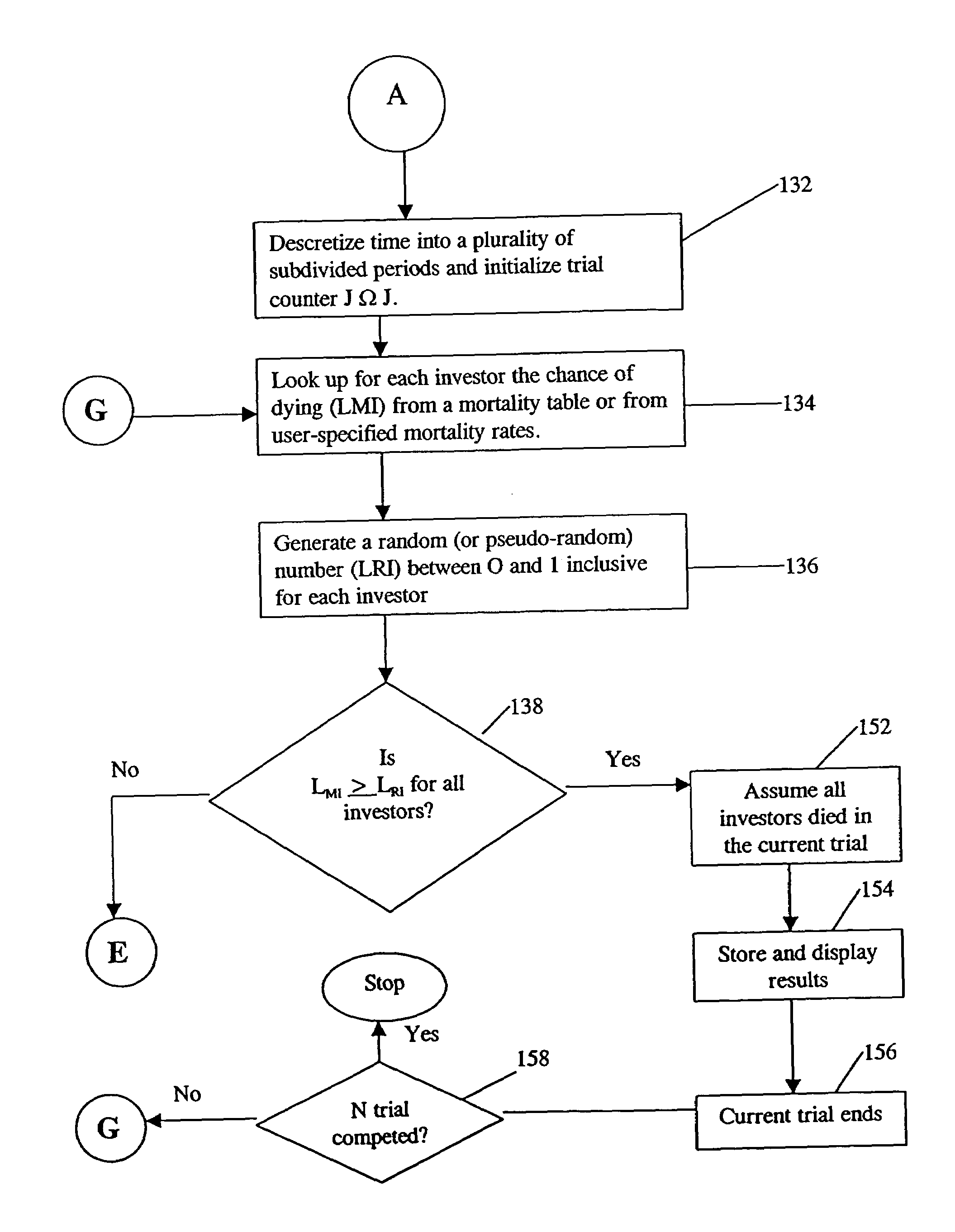

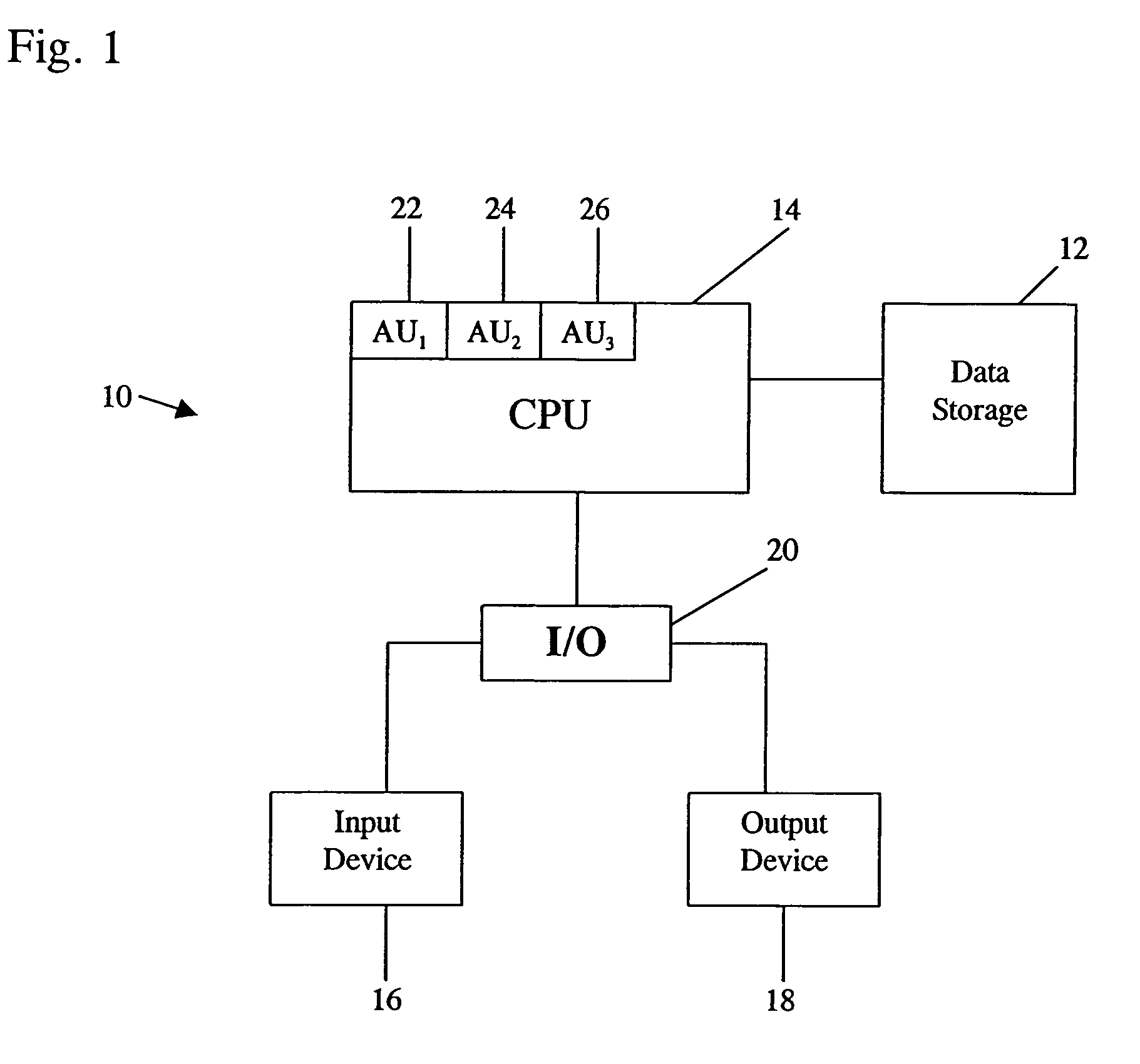

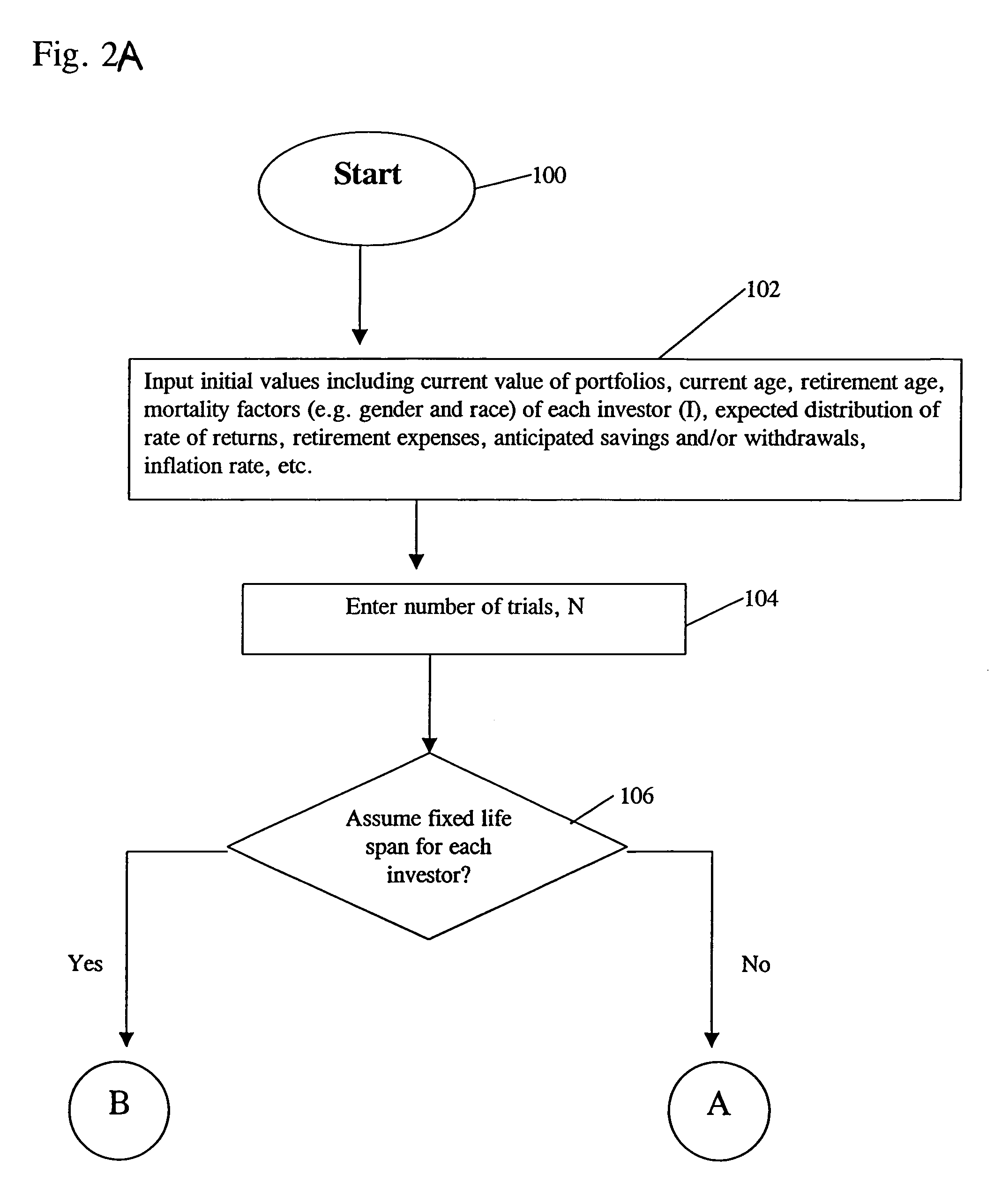

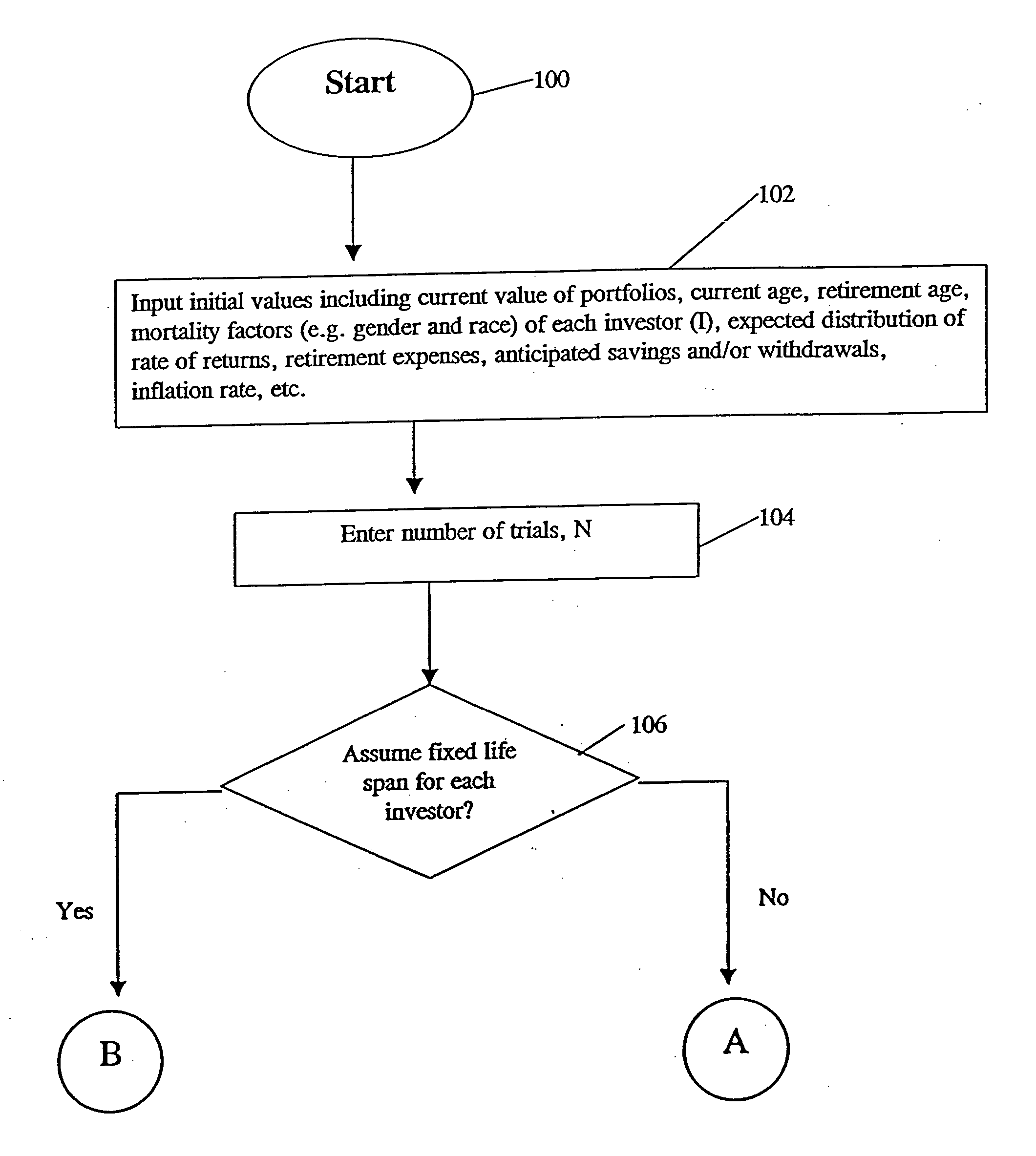

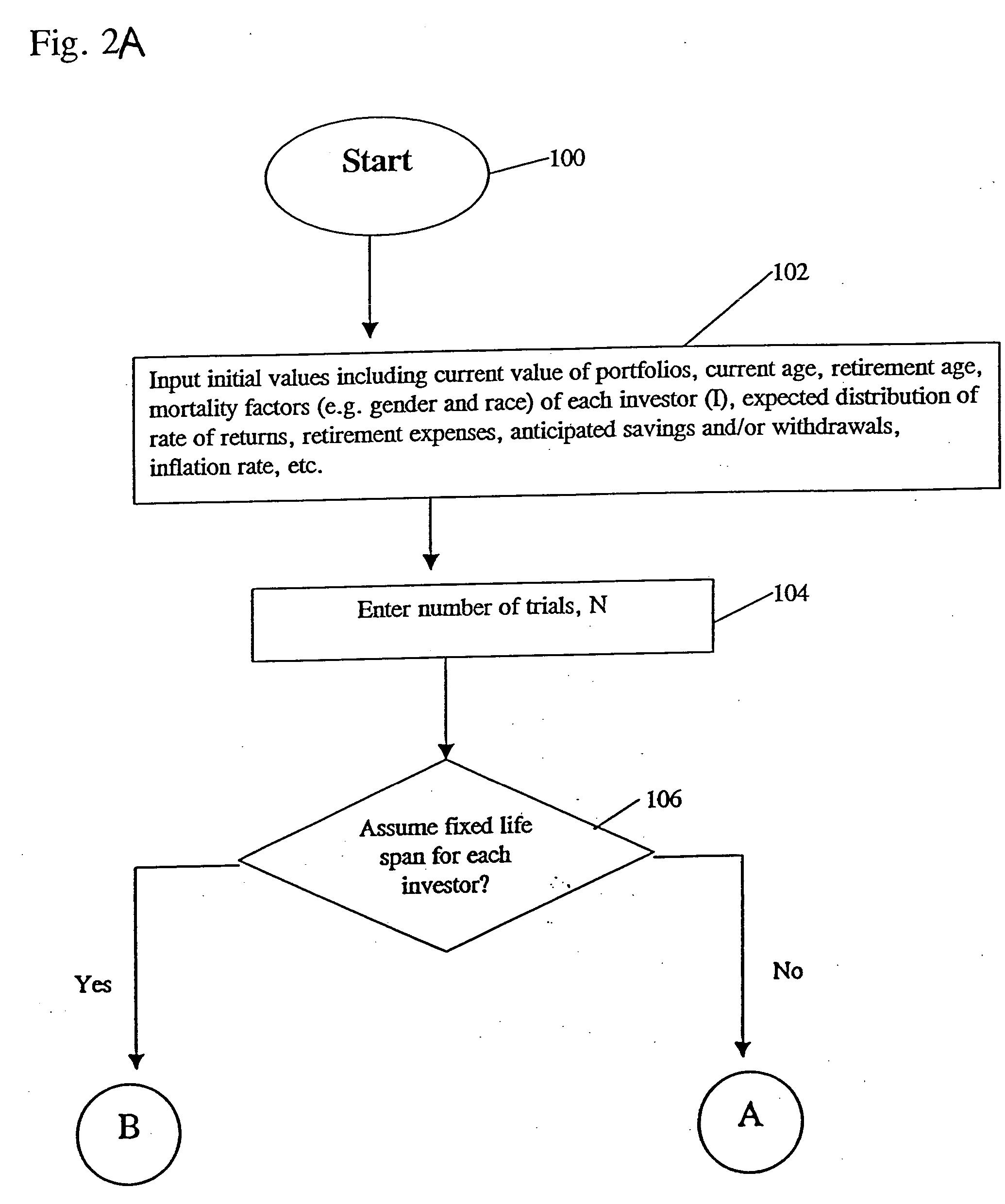

System and method for incorporating mortality risk in an investment planning model

A retirement planning method for computing possible future values of a portfolio of an investor. In one embodiment, the method includes the steps of (a) receiving a plurality of user inputs comprising an initial value of the portfolio and a current age of the investor; (b) providing data indicating one of cumulative probabilities of living to an age of death and cumulative probabilities dying at an age of death for persons of a given age group; (c) randomly drawing a number between 0 and 1 for the investor; (d) defining the randomly drawn number as one of said one of cumulative probabilities of living to an age of death and cumulative probabilities of dying at an age of death; (e) determining an age of death of the investor in accordance with said data based on the current age of the investor and the randomly drawn number; (f) computing a future value of the portfolio using the age of death of the investor determined in step (e), a predetermined rate of return, and the initial value of the portfolio; and (g) outputting the computed future value of the portfolio.

Owner:MACEY HOLLAND

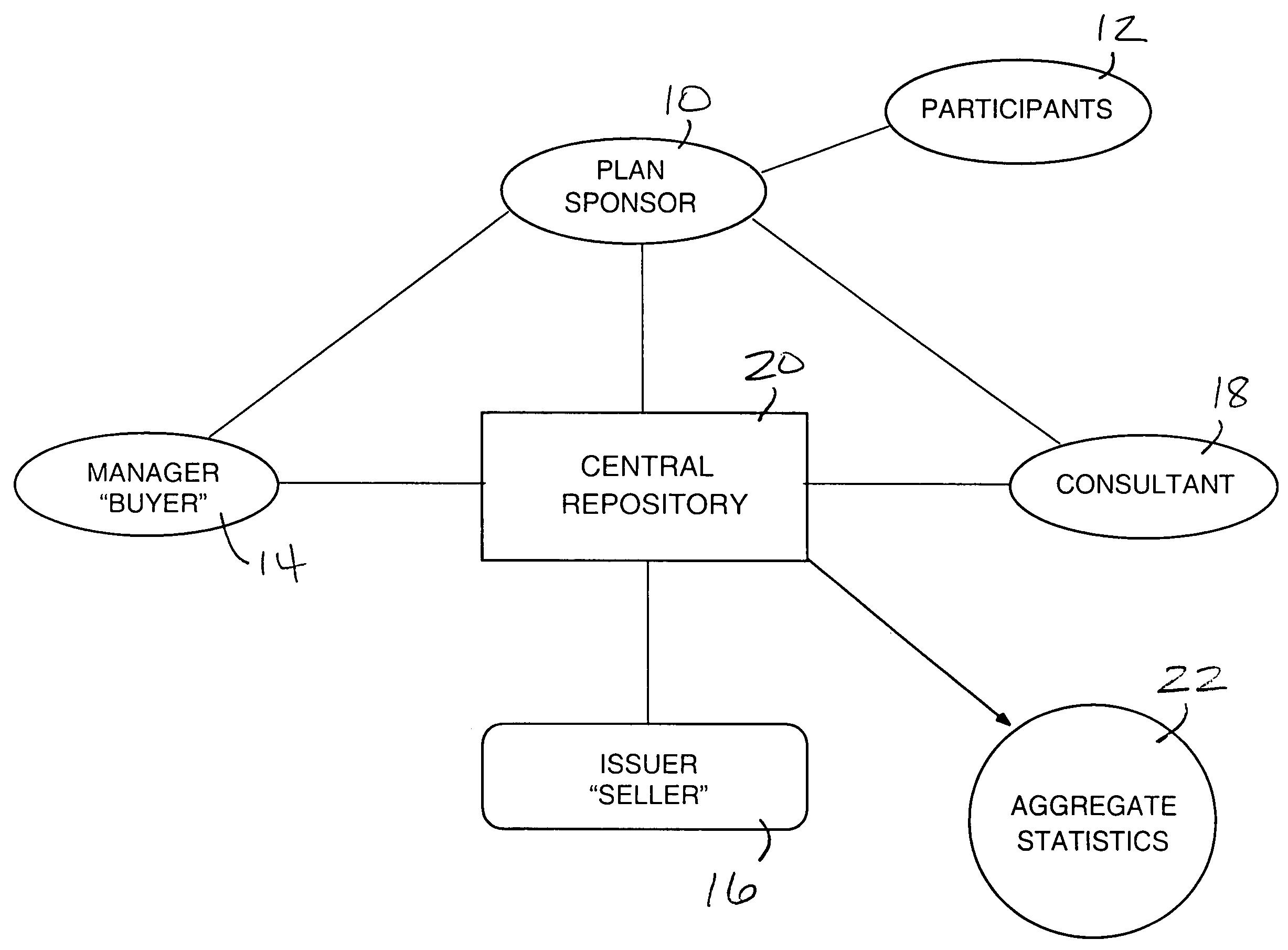

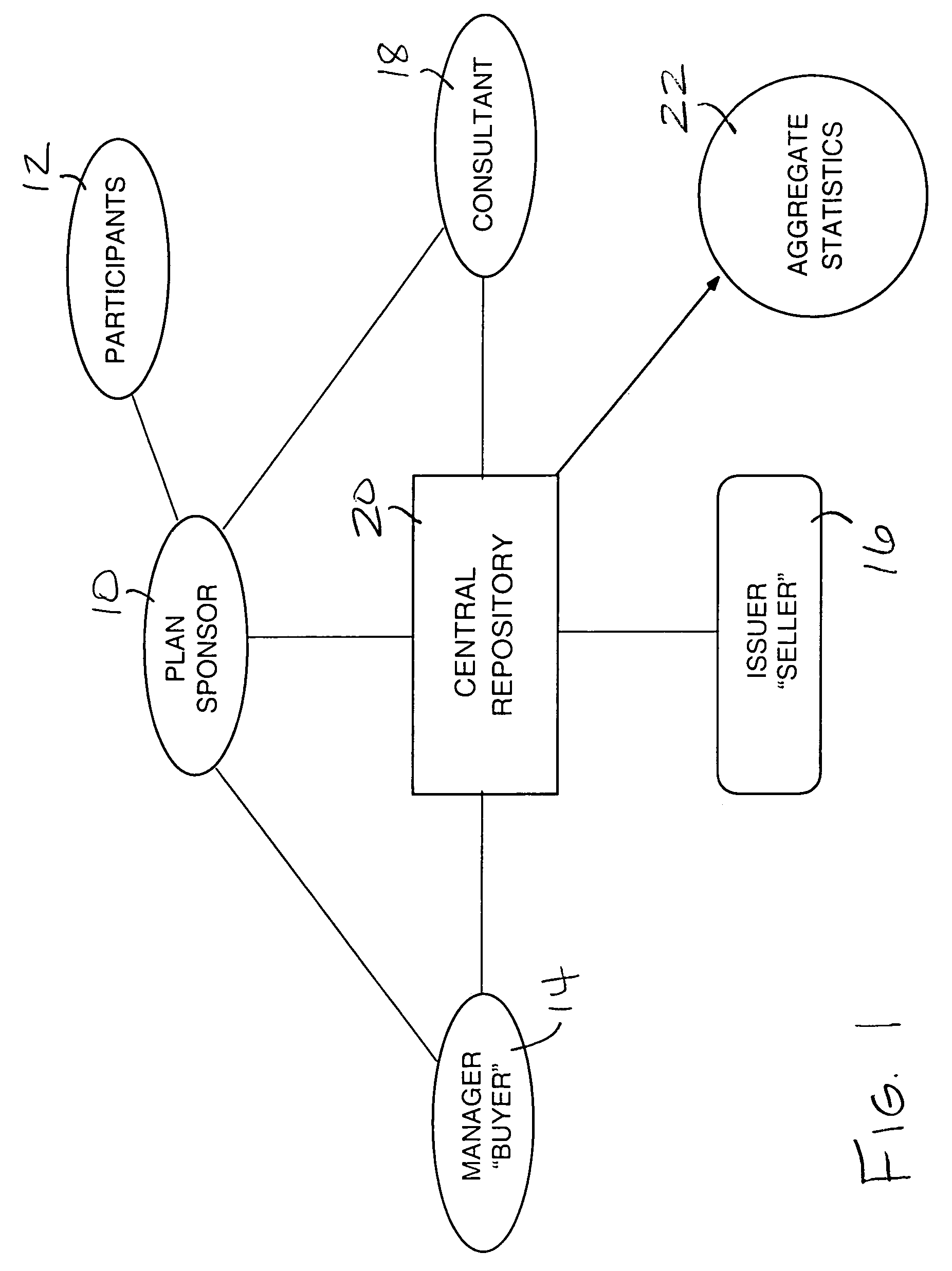

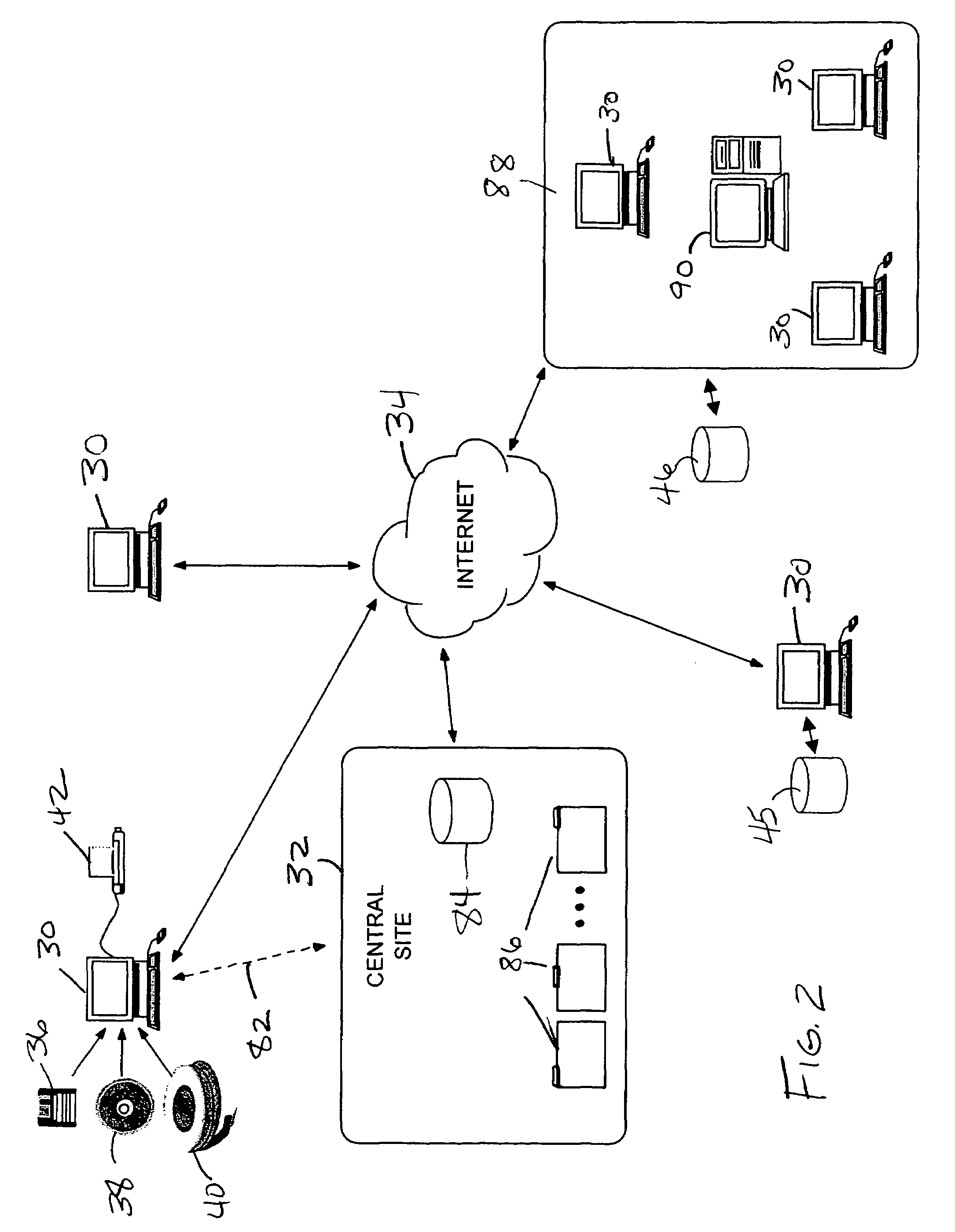

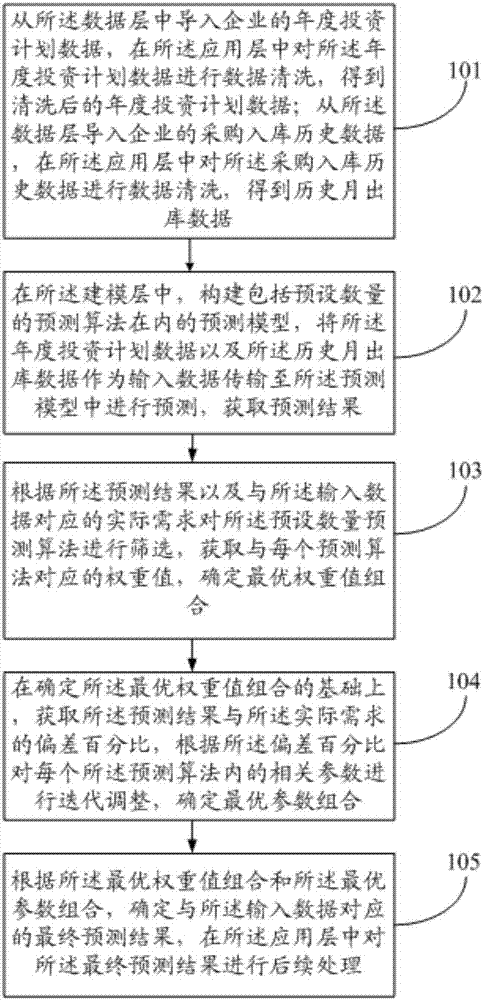

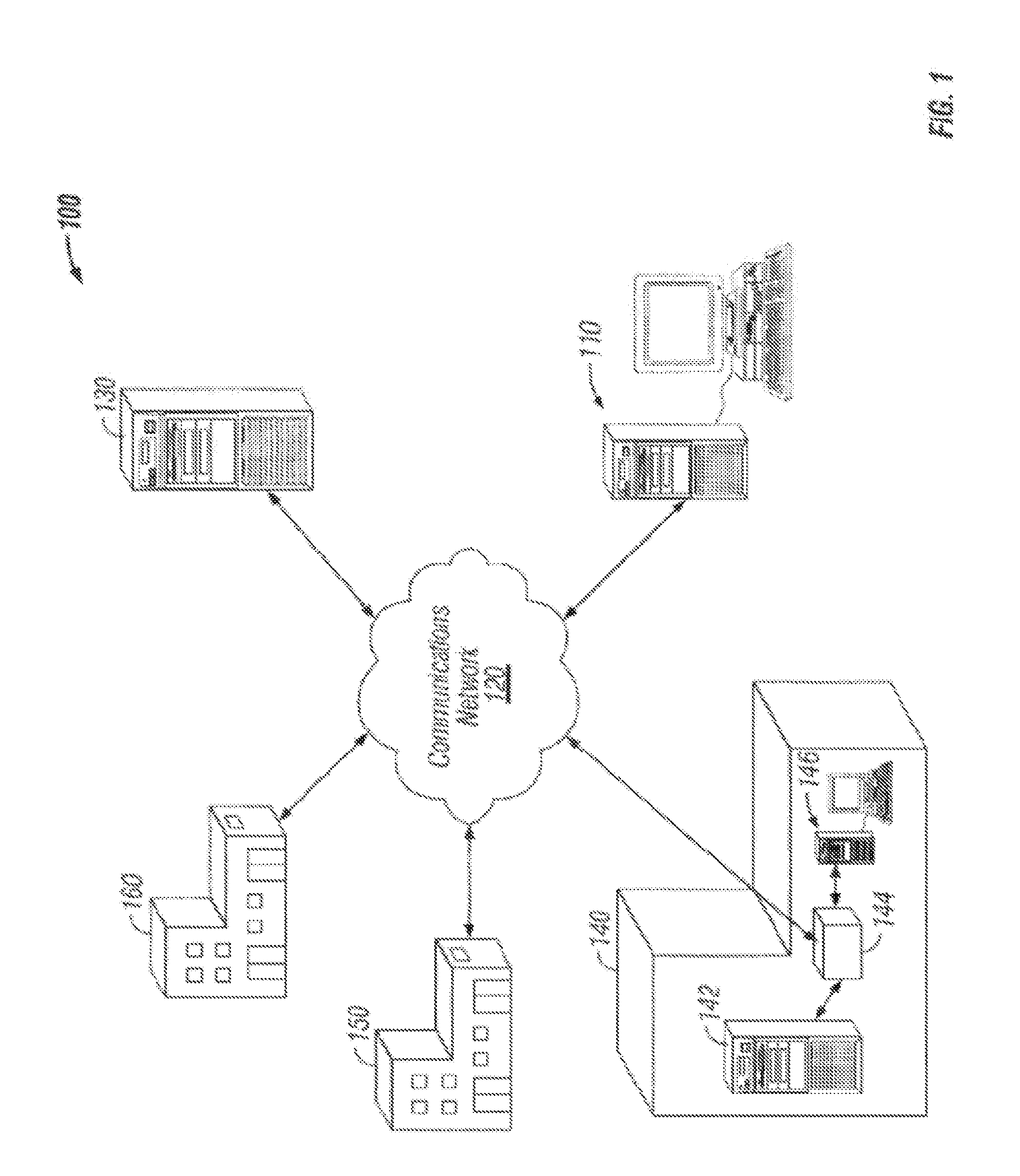

Electronic communication system and method for facilitating financial transaction bidding and reporting processes

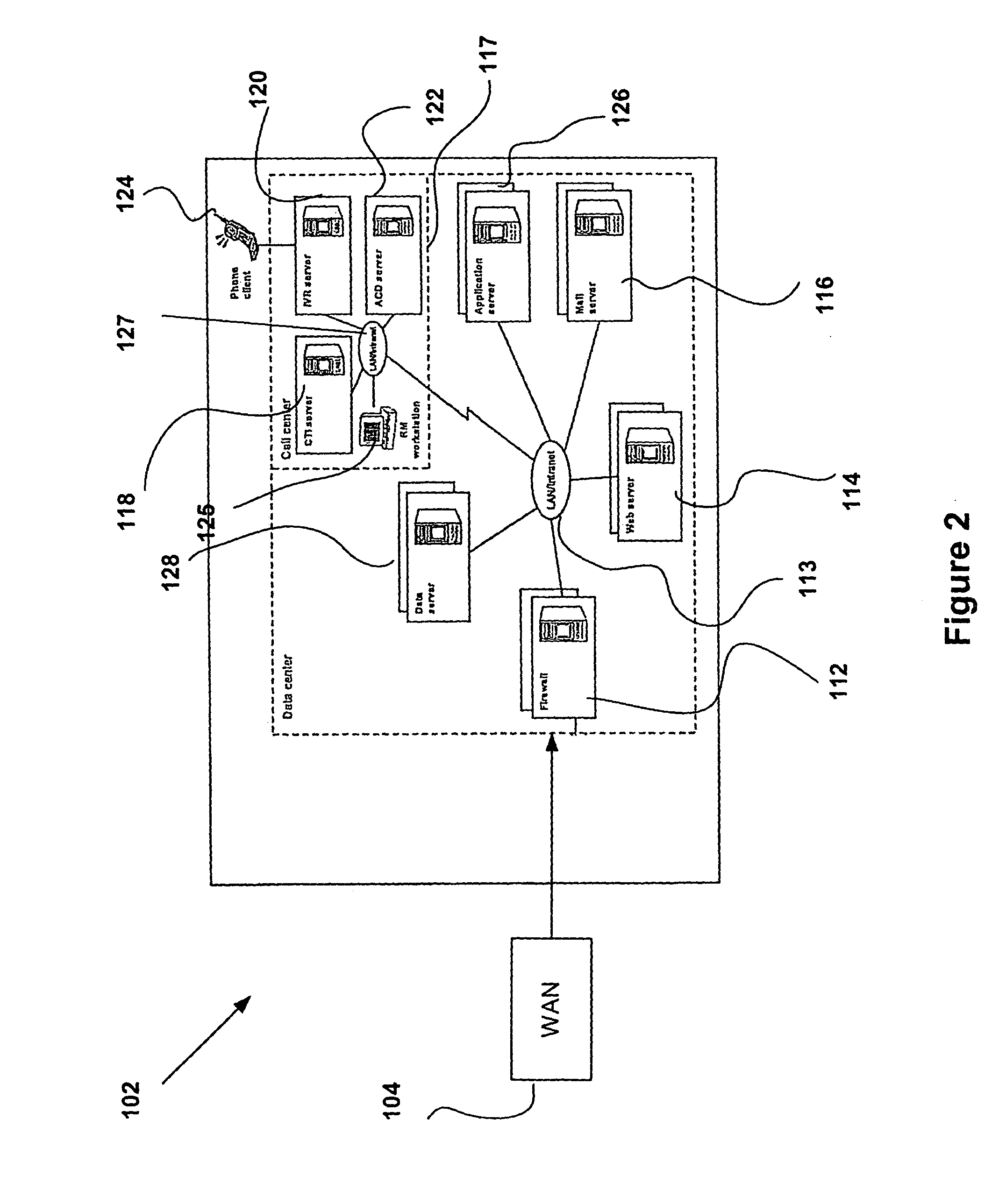

InactiveUS7313540B1Financial transaction facilitatedFinanceComputer security arrangementsElectronic communicationData field

A system and method for electronically communicating investment plan information between money managers and issuers of investment contracts to facilitate plan inquiry and plan bidding processes. An import specification is defined, identifying database format characteristics of investment plan information stored in a first database. Data fields are mapped from the first database to data fields in a second database to create a data import map, where the data fields in the second database are predefined data fields. Investment plan information is imported into the predefined data fields of the second database according to the import specification and data import map. The resulting imported information is transferred to a central database accessible by investment contract sellers who are authorized by the investment contract buyers to receive the investment plan information. The investment plan information is transferred from the central database to the authorized investment contract sellers upon request of the authorized investment contract sellers. A proposed investment contract may then be created using the investment plan information received via the central database.

Owner:HUELER

System and method for incorporating mortality risk in an investment planning model

A retirement planning method for computing possible future values of a portfolio of an investor. In one embodiment, the method includes the steps of (a) receiving a plurality of user inputs comprising an initial value of the portfolio and a current age of the investor; (b) providing data indicating one of cumulative probabilities of living to an age of death and cumulative probabilities dying at an age of death for persons of a given age group; (c) randomly drawing a number between 0 and 1 for the investor; (d) defining the randomly drawn number as one of said one of cumulative probabilities of living to an age of death and cumulative probabilities of dying at an age of death; (e) determining an age of death of the investor in accordance with said data based on the current age of the investor and the randomly drawn number; (f) computing a future value of the portfolio using the age of death of the investor determined in step (e), a predetermined rate of return, and the initial value of the portfolio; and (g) outputting the computed future value of the portfolio.

Owner:MACEY REX

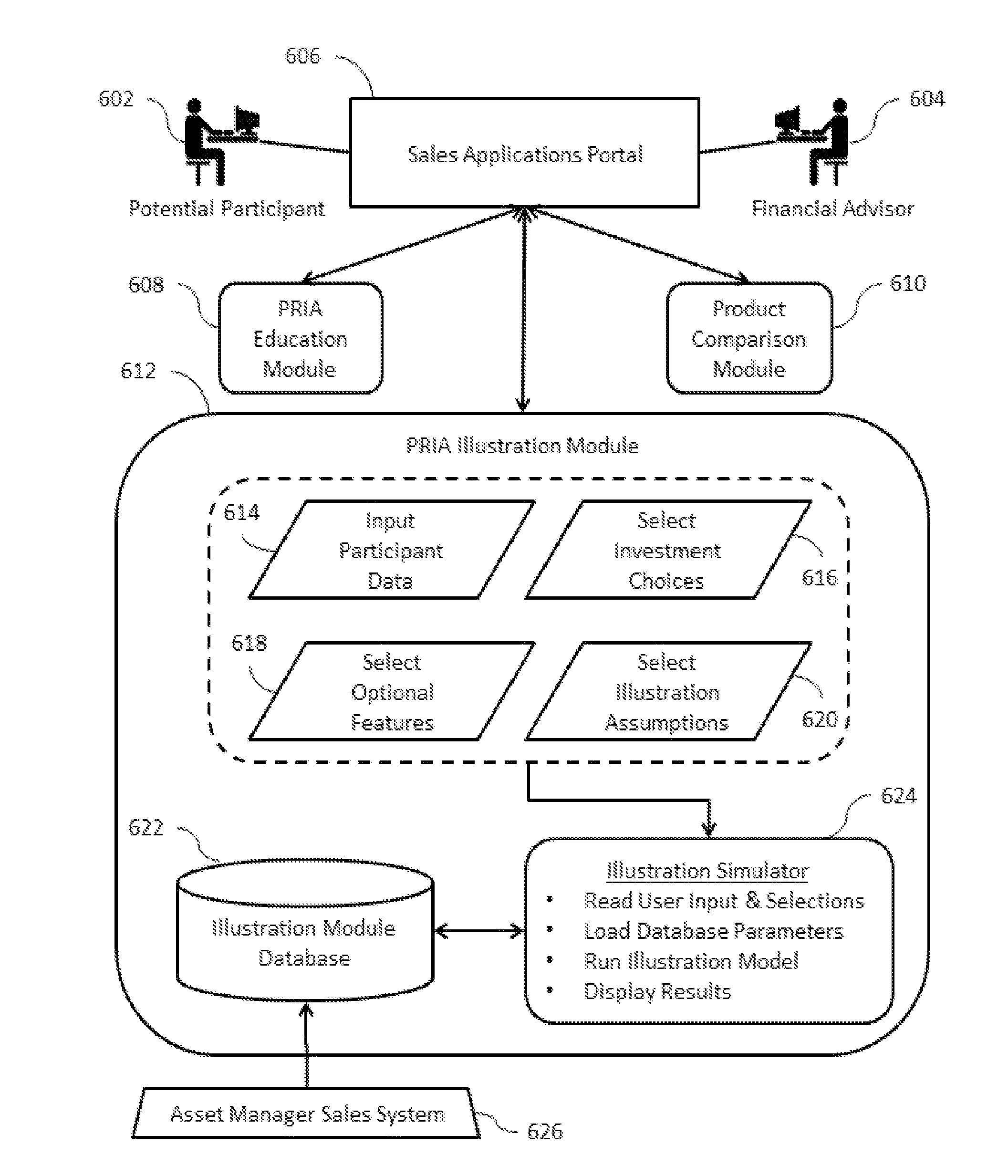

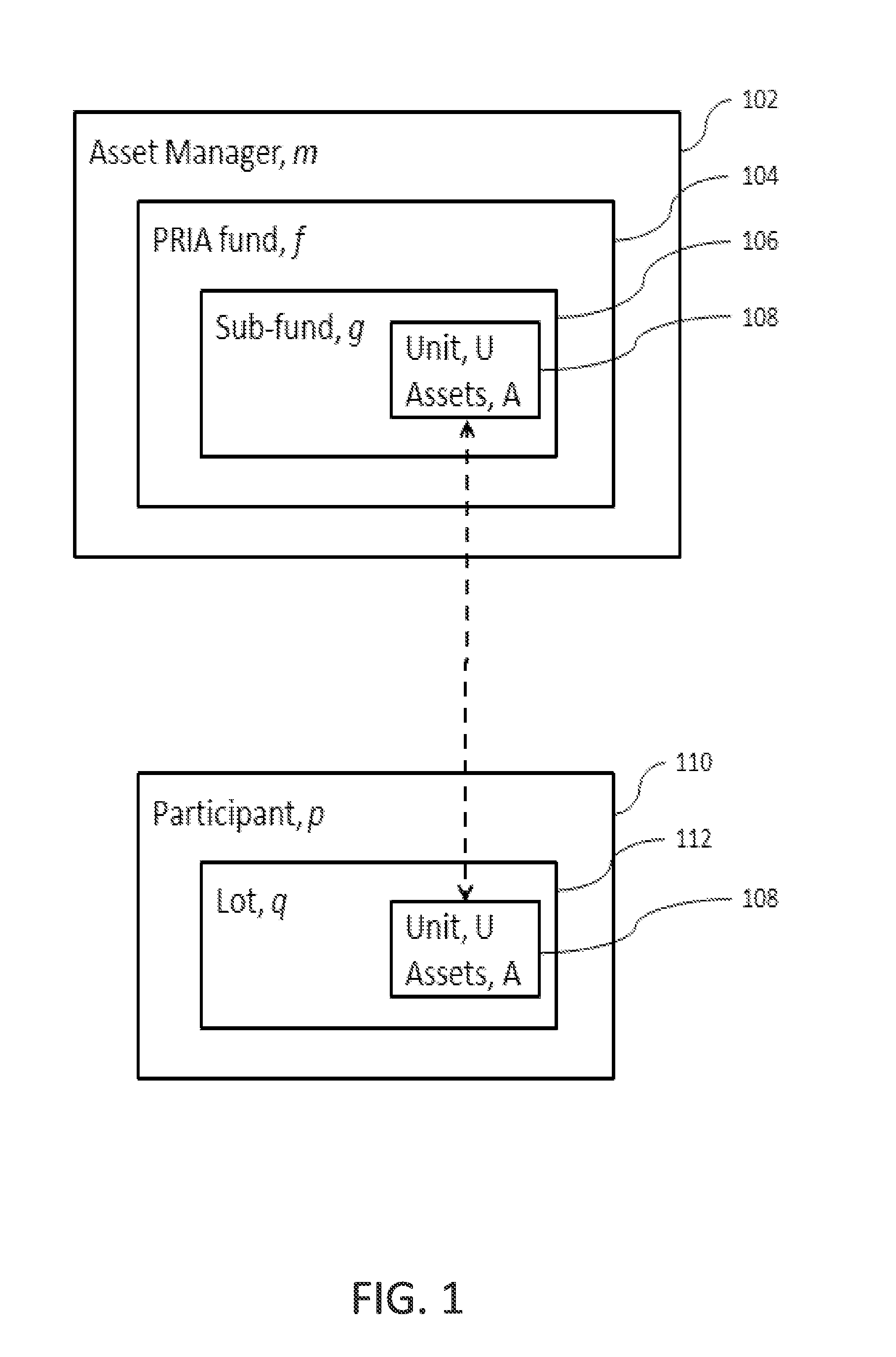

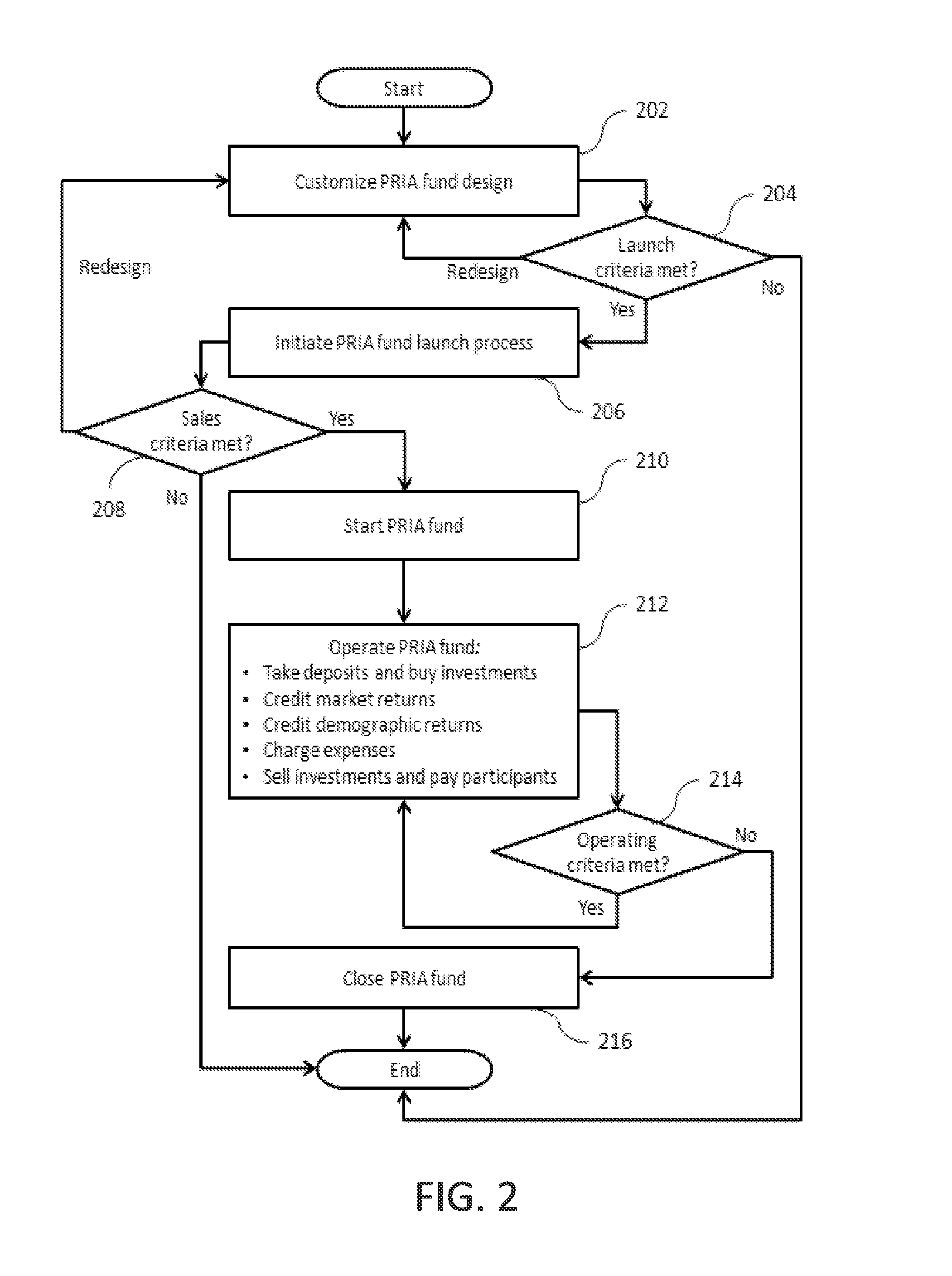

Interactive methods and systems for control of investment data including demographic returns

A computer-implemented method, system, and apparatus for managing investment savings of individuals through an investment vehicle suitable for retirement, estate or general investment planning. The invention establishes the mechanics of the operations to create an open-end investment fund as a means for individual participants to earn both market returns on their investments and demographic returns (DR) on the actual demographic experience of the pool of investors who participate in the investment fund. Individuals can invest in the fund and make additional deposits and withdrawals at any time. Investors specify a payout schedule, and those who sell their investments, as scheduled, earn full returns, combining market returns and the DR. Investors who make unscheduled withdrawals from the fund, receive lower returns. The investment fund is customized, and administered by computer software that is available to both participants in the fund and to asset managers who offer the fund to investors.

Owner:SHIMPI PRAKASH

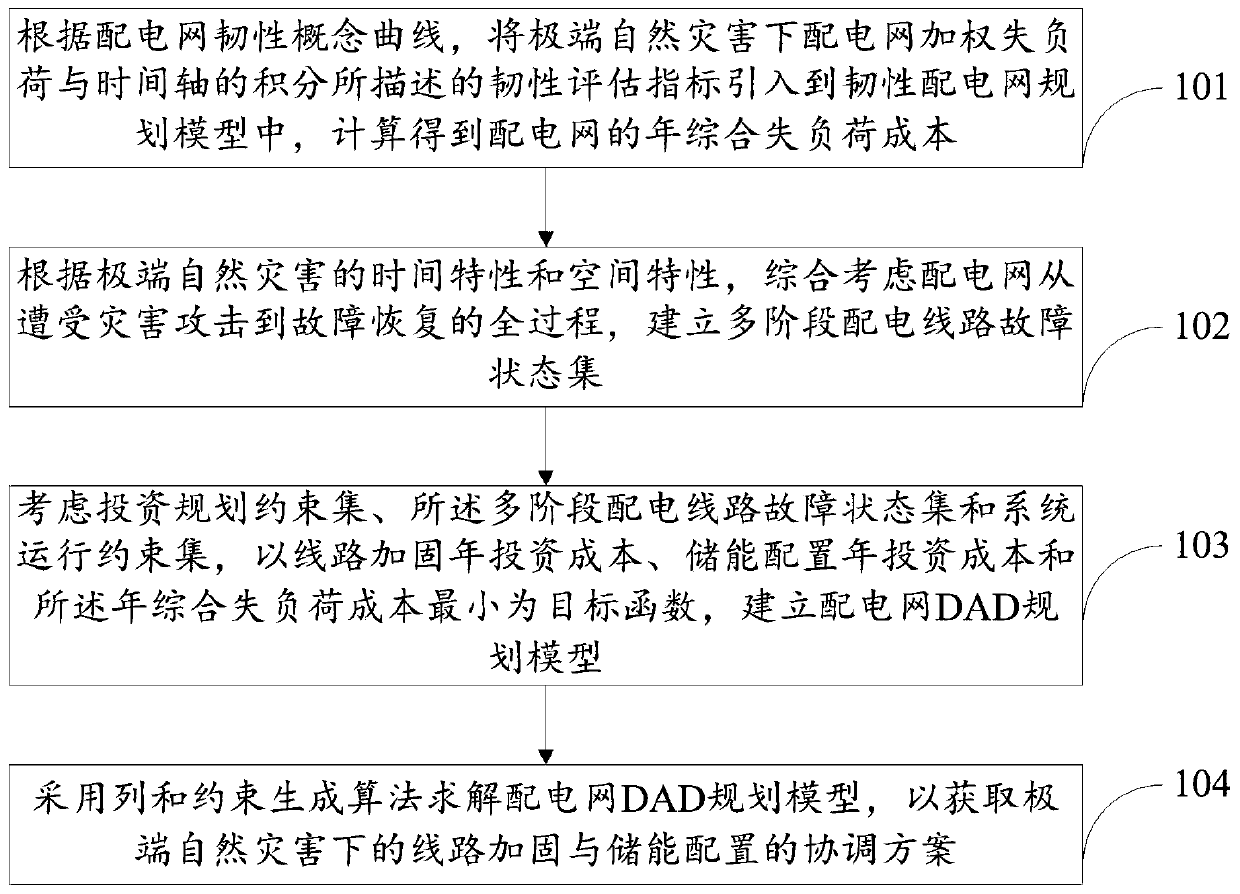

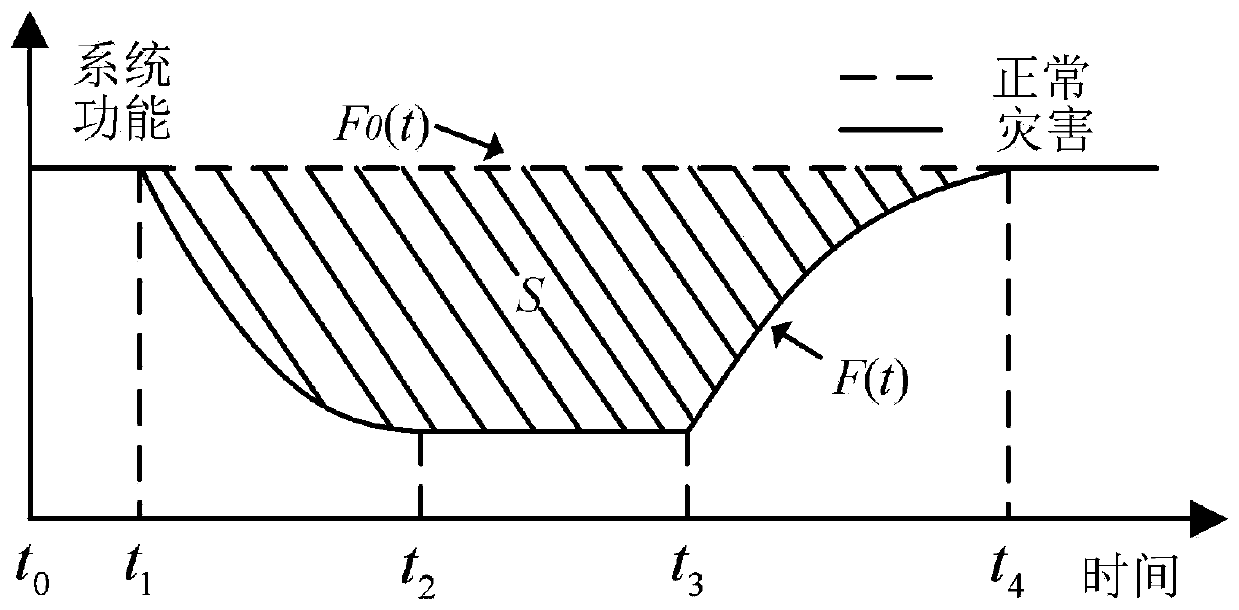

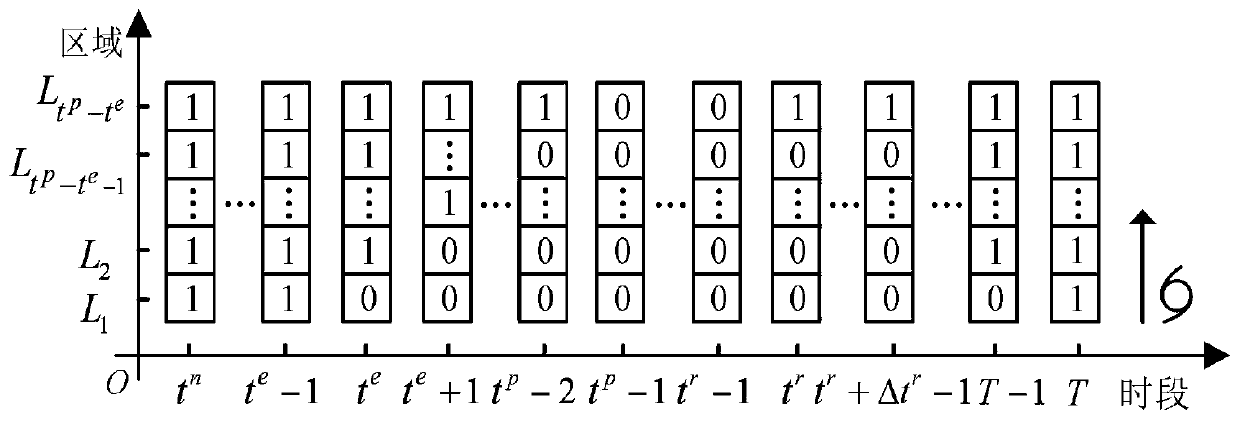

Tough power distribution network planning method and system considering energy storage configuration under extreme natural disasters

ActiveCN110571807AImproving the ability to deal with extreme natural disastersAnnual comprehensive loss of load cost reductionAc network circuit arrangementsNatural disasterInvestment planning

The invention discloses a tough power distribution network planning method and system considering energy storage configuration under extreme natural disasters, and relates to the technical field of tough power distribution network planning. The method comprises the steps of considering a toughness concept curve of a power distribution network and calculating annual comprehensive loss-of-load costof the power distribution network; according to a time characteristic and a space characteristic of the extreme natural disasters, considering a whole process from a disaster attack to fault recoveryof the power distribution network, and establishing a multi-stage power distribution line fault state set; considering an investment planning constraint set, a multi-stage power distribution line fault state set and a system operation constraint set, and establishing a power distribution network DAD planning model by taking minimums of annual investment cost of line reinforcement, the annual investment cost of energy storage configuration and the annual comprehensive loss-of-load cost as target functions; and solving by adopting a column and constraint generation algorithm to obtain a coordination scheme of line reinforcement and energy storage configuration under the extreme natural disasters. By adopting the method or the system of the invention, a disaster response capability of the tough power distribution network can be improved, and the investment cost is reduced.

Owner:NORTH CHINA ELECTRIC POWER UNIV (BAODING) +1

An accurate investment planning method for medium-voltage distribution network under the environment of electric transformation

InactiveCN109409699ARaise the level of reliabilityImprove scienceResourcesInformation technology support systemEngineeringLoad distribution

The invention provides an accurate investment planning method for medium-voltage distribution network under the environment of electric transformation, which comprises the following steps: dividing apower supply grid and a power supply unit; distribution network diagnosis; Forecast load distribution; classification and division of supply area in planning area; planning area substation optimization planning; constructing the target grid of medium voltage distribution network; constructing medium voltage distribution network frame in transitional year; Investment Estimation and Electrical Calculation Analysis of Planning Scheme; carry out power flow calculation, short-circuit current calculation and quantitative analysis of power supply safety for the planning area.

Owner:STATE GRID CHONGQING ELECTRIC POWER

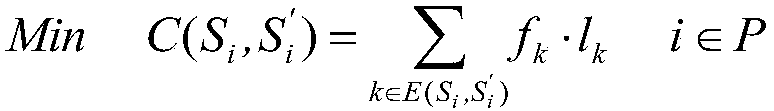

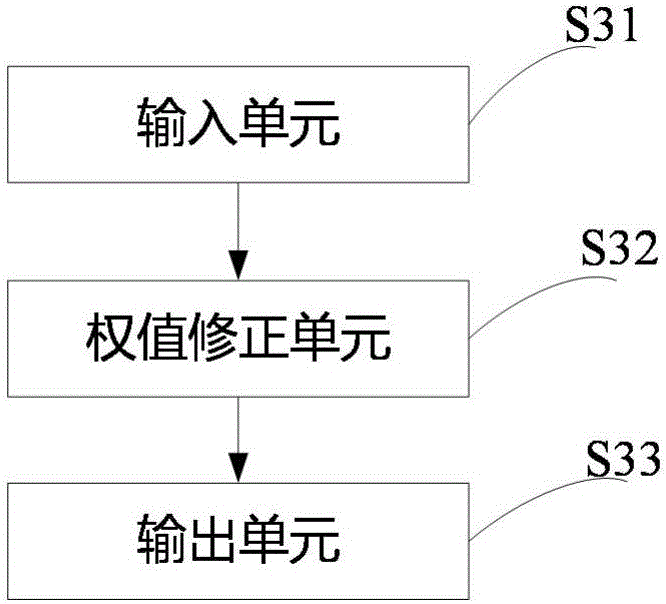

Power material purchasing demand prediction system for distribution network

The invention provides a power material purchasing demand prediction system for a distribution network, and belongs to the field of prediction systems. The system employs a method which comprises the steps: obtaining yearly investment plan data and historical monthly delivery data from a data layer, carrying out the data cleaning of the data in an application layer, transmitting the data to a prediction model in a modeling layer for prediction after cleaning, obtaining a prediction result, determining an optimal weight value combination and an optimal parameter combination according to the comparison of the prediction result with an actual demand so as to determine a final prediction result, and carrying out the subsequent processing of the final prediction result in the application layer. The data obtained from the data layer is cleaned through the application layer, and the data is transmitted to the prediction model in the modeling layer for prediction, thereby obtaining the prediction result. The optimal weight value combination is determined according to the comparison between the prediction result and the actual demands, and the optimal parameter combination is determined according to a deviation percentage, thereby determining the final prediction result. The difference between the final prediction result and the actual demand is very small, thereby improving the accuracy of the prediction result.

Owner:STATE GRID ZHEJIANG ELECTRIC POWER +1

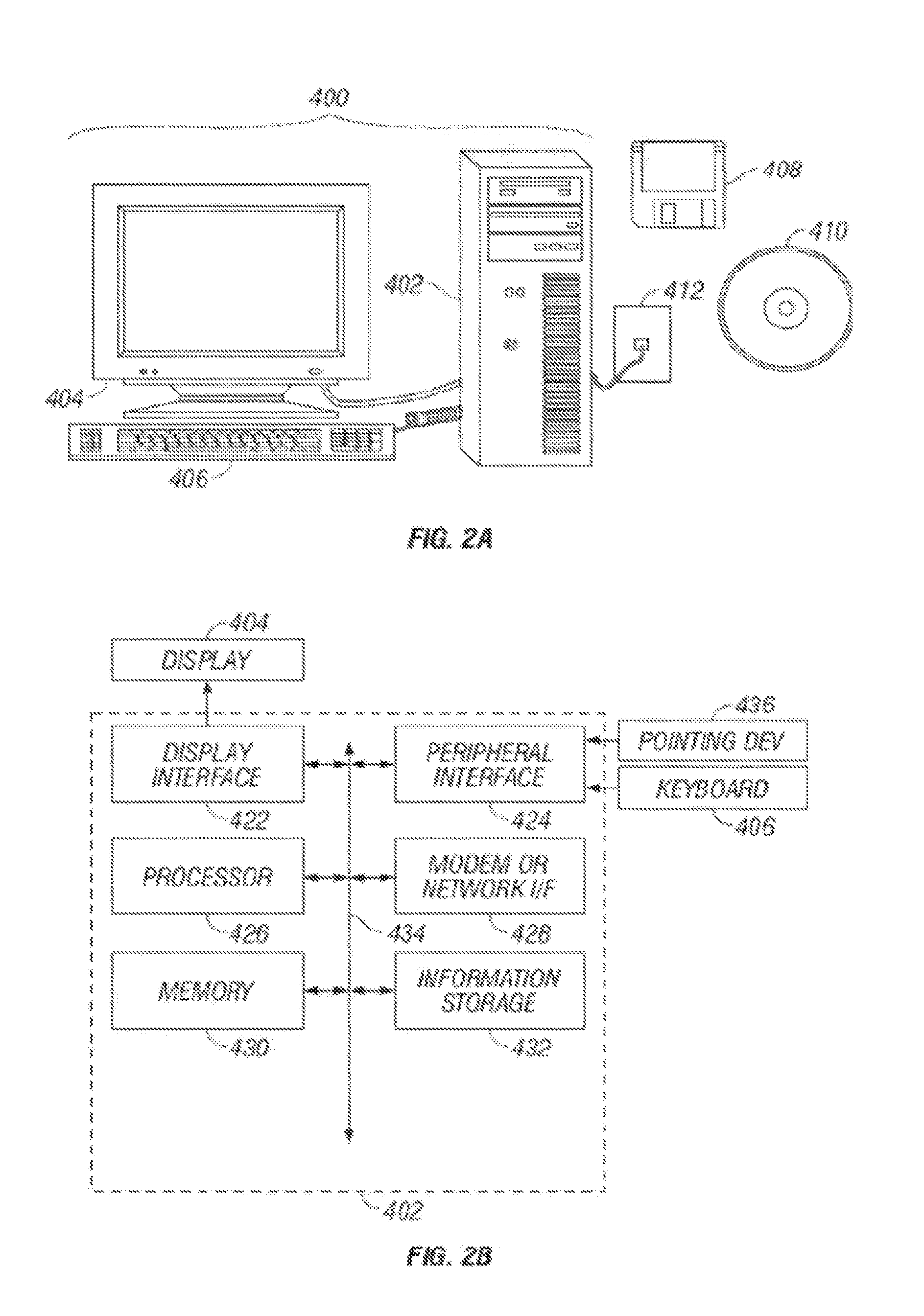

Predictive, integrated software designed to optimize human and financial capital over life of user

A method, system, and machine-readable medium with instructions for performing the method configured to meet a financial goal. The method includes accepting user information, estimating a target volatility of the user, preparing an investment plan based on the user information and the target volatility, and providing the investment plan to the user. The target volatility may be determined using a revealed risk tolerance based on behavioral analytics. The method may also include preparing and presenting an insurance plan to protect human capital of the user and pooling buying power of the user with additional parties to realize discounts on goods and services. The system includes a computer for executing instructions to perform the method and communicating with the user.

Owner:TECTONIC ADVISORS LLC

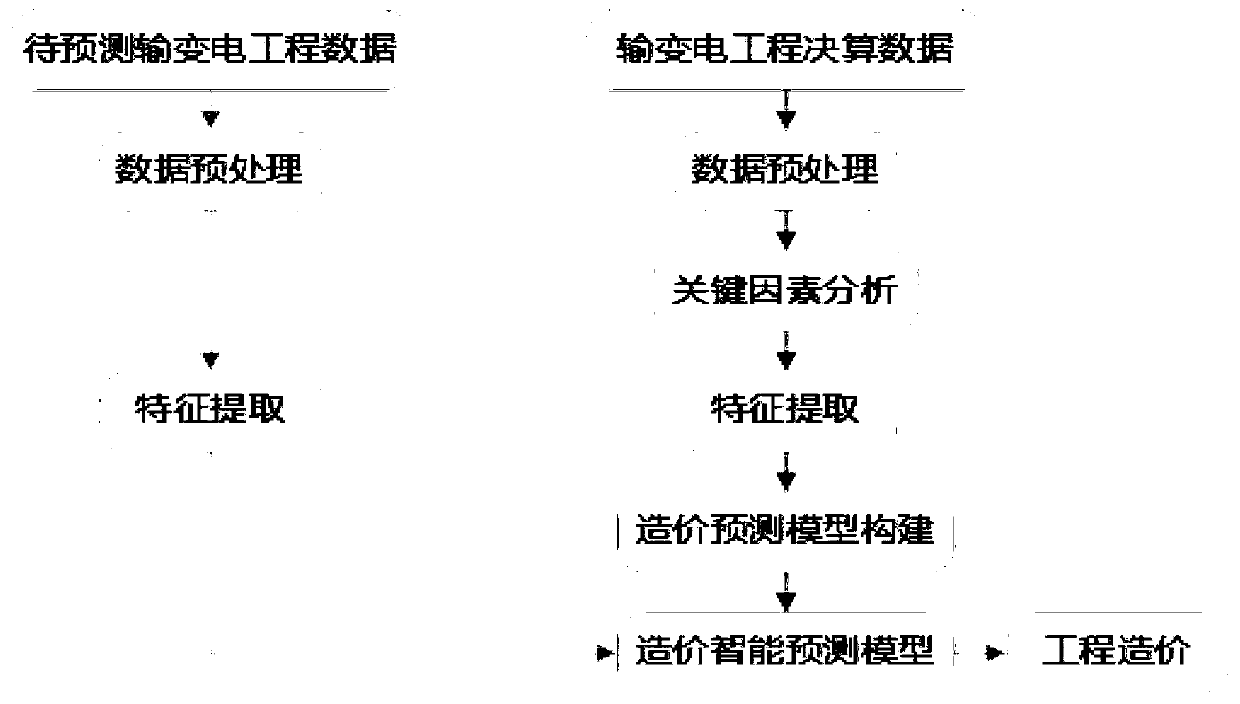

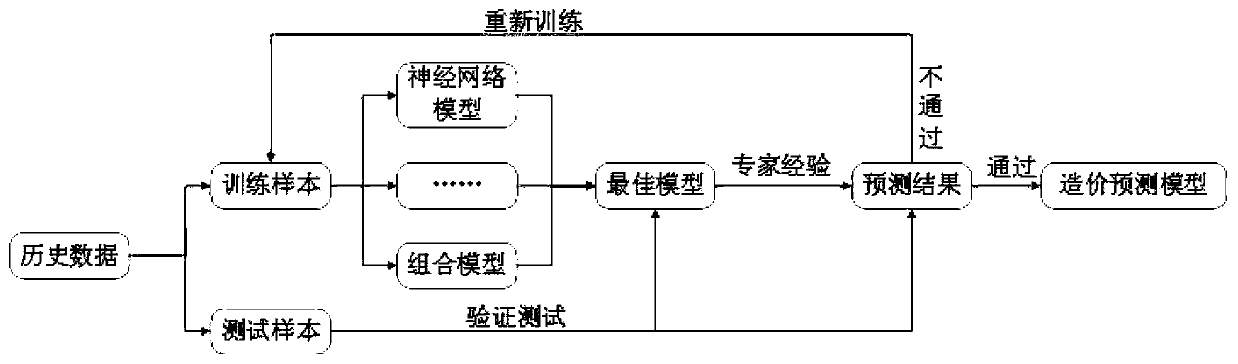

Infrastructure substation project cost prediction method based on neural network intelligent algorithm

PendingCN110992113AOvercome the shortcoming of underestimating pre-controlFully setMarket predictionsBiological neural network modelsData setEngineering

The invention provides an infrastructure substation project cost prediction method based on a neural network intelligent algorithm. The method is characterized by comprising the following steps of: collecting existing power transmission and transformation project final settlement data as a sample, preprocessing the sample data to form a data set, screening out a key factor set from an original factor library of the data set for further analysis, extracting feature parameters, and constructing a cost prediction model according to the feature parameters of a database, preprocessing the power transmission and transformation project data to be predicted, extracting characteristic parameters, and substituting the characteristic parameters into the cost prediction model to obtain the project cost. The accuracy and the rationality of investment plan arrangement are ensured, the company power grid asset transfer rate is improved, and important support is provided for company power transmissionand distribution price stability.

Owner:STATE GRID HUBEI ELECTRIC POWER COMPANY +2

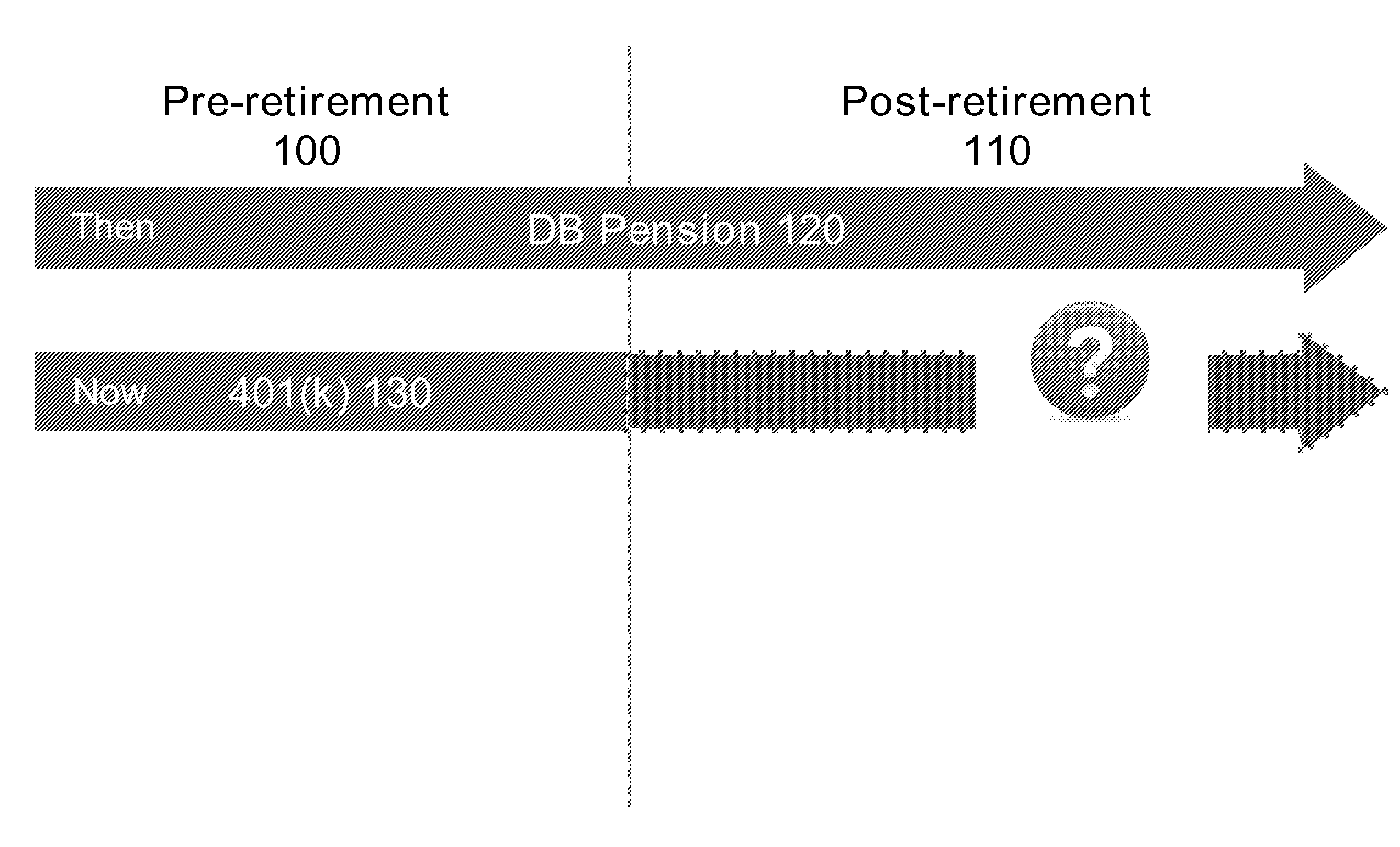

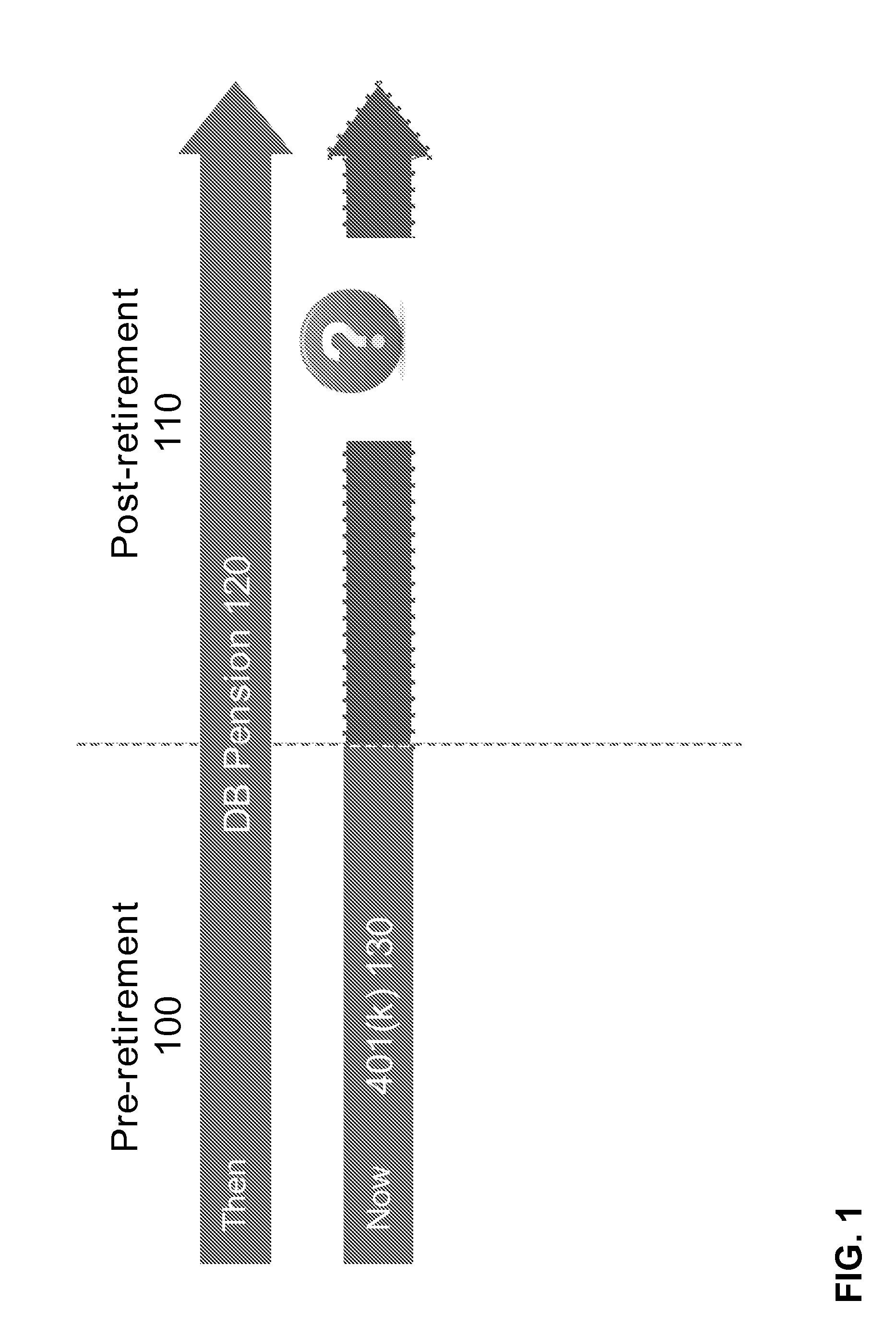

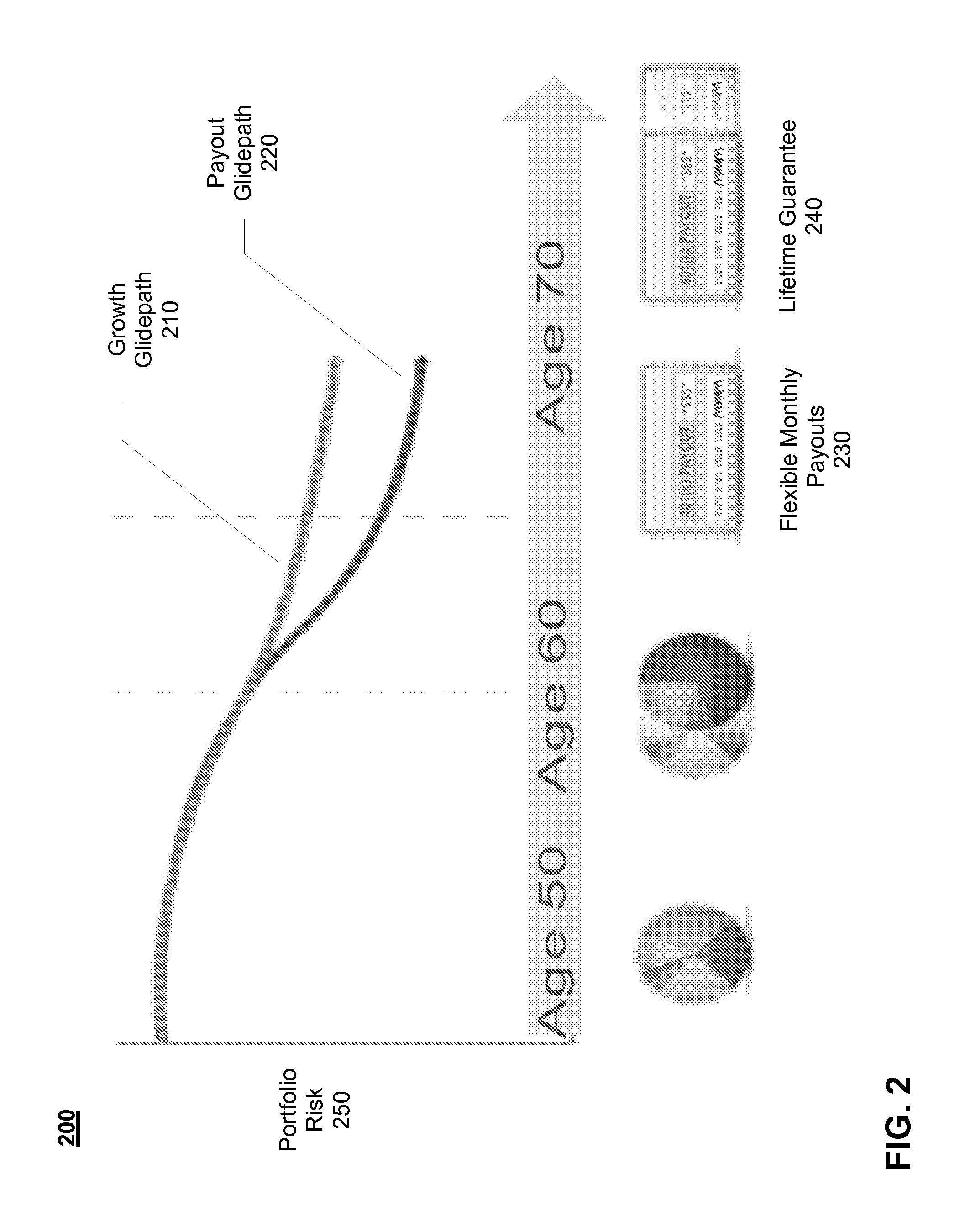

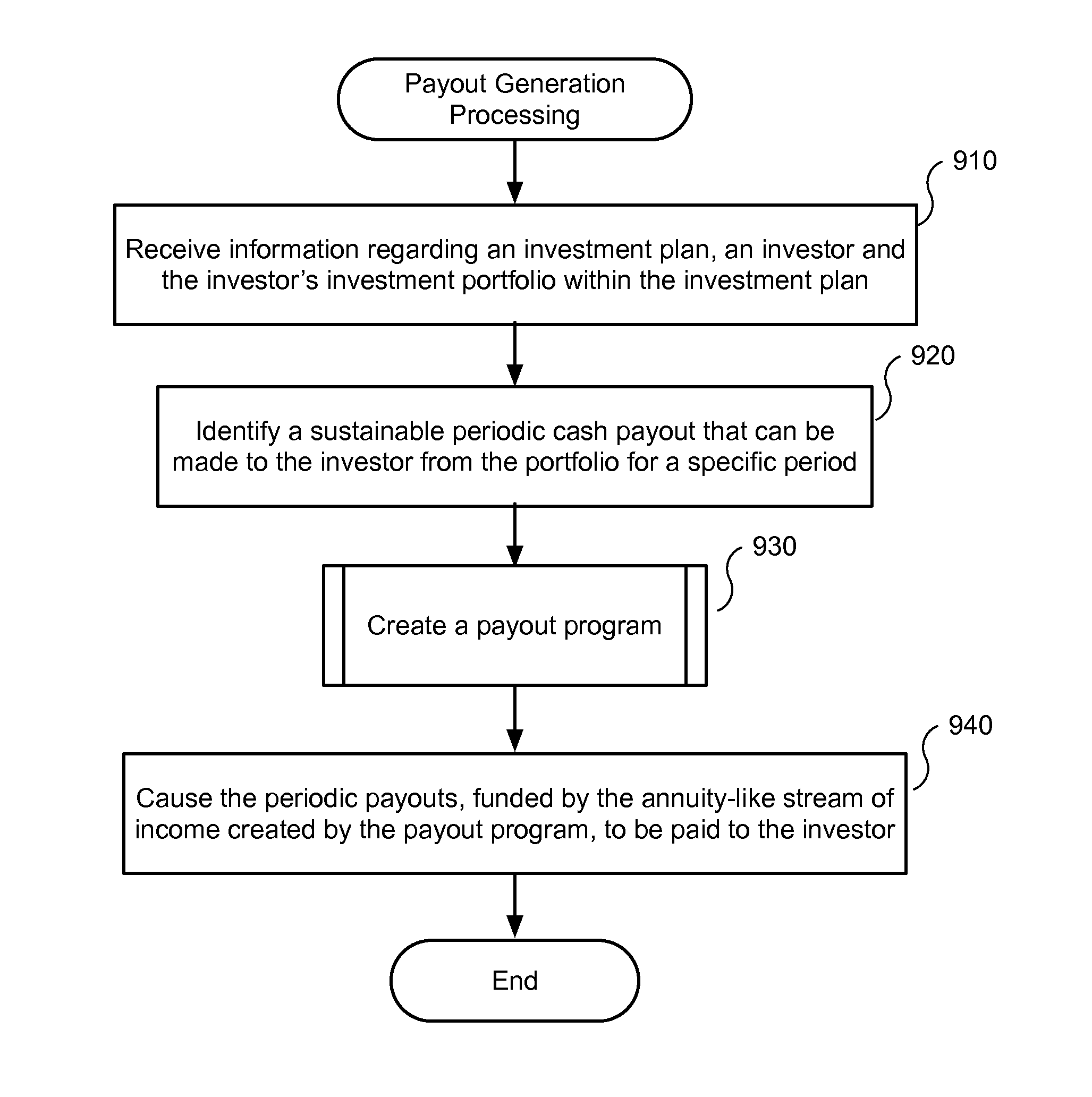

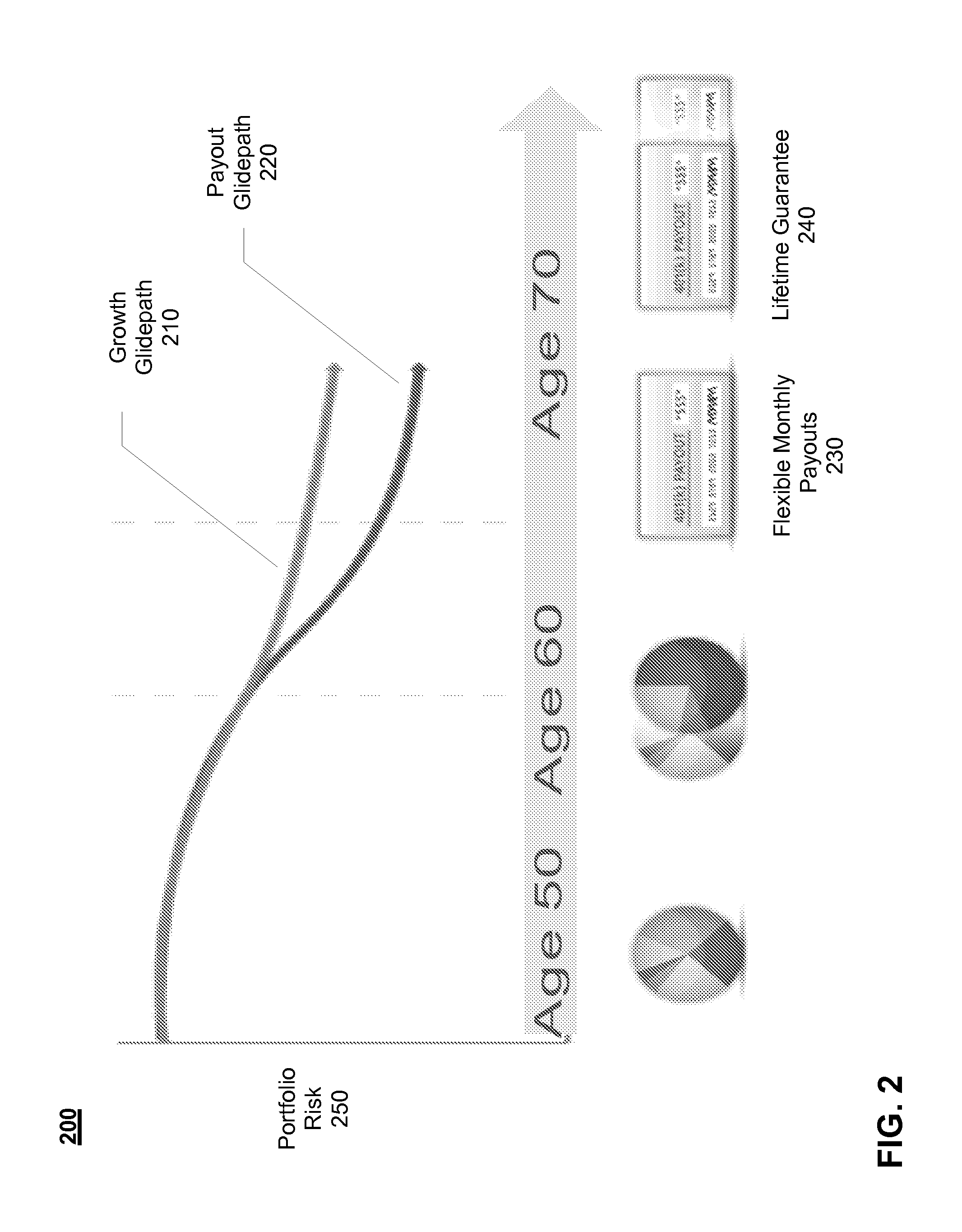

Creating and maintaining a payout-ready portfolio within an investment plan to generate a sustainable income stream

Financial advisory methods and systems for creating a steady lifetime income stream within an investment plan is provided. According to one embodiment, based on an investor's current holdings in the investment plan, a pattern of periodic cash payouts is identified that can be made to the investor from an in-plan payout program implemented with the limited universe of financial products available within the investment plan. The assets of the investment plan are rebalanced to form a payout portfolio and an equity exposure portfolio. The payout portfolio is constructed to create an annuity-like stream of income to support the pattern of periodic cash payouts and includes multiple bond funds. The equity exposure portfolio is constructed to address inflation risk by providing an ability to rise with equities markets. Finally, a periodic cash payout of the pattern of periodic cash payouts is caused to be paid to the investor from the investment plan.

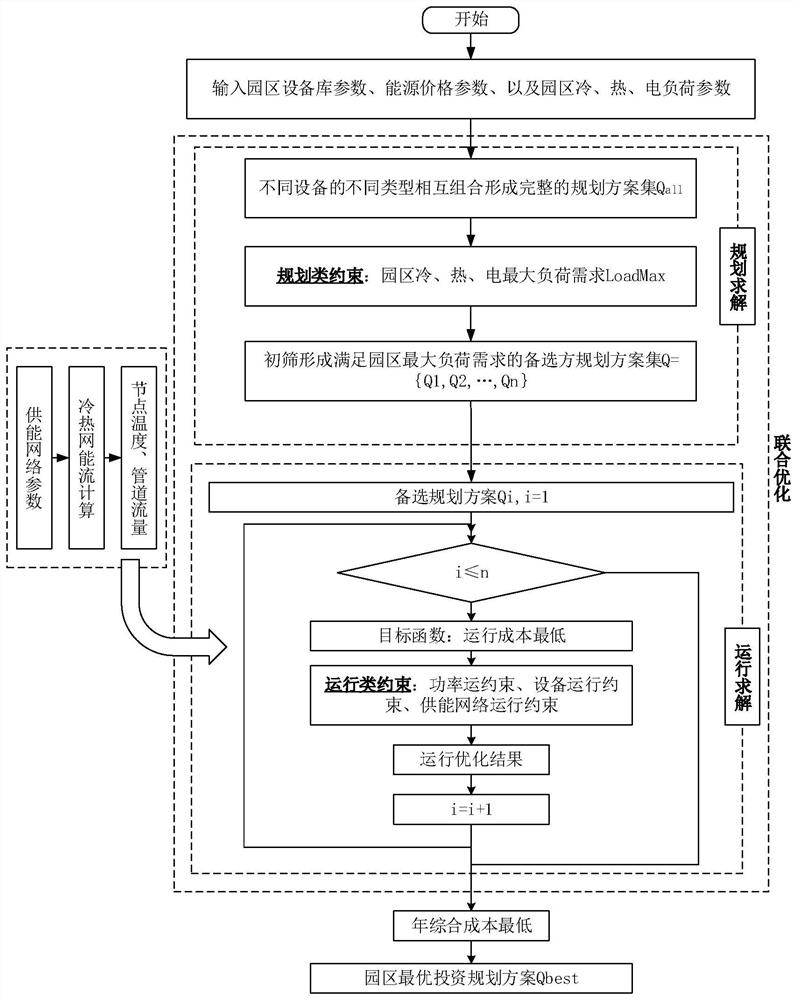

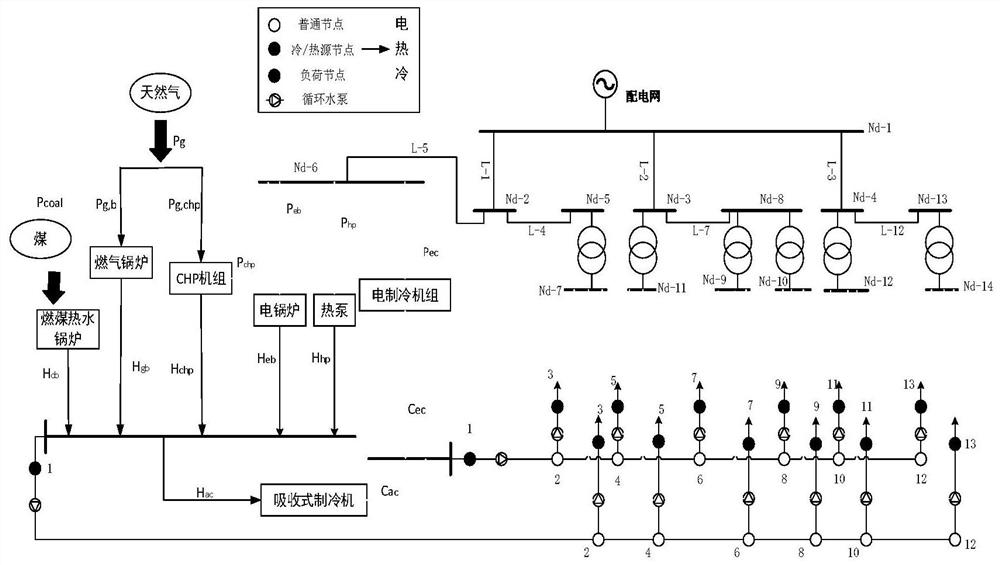

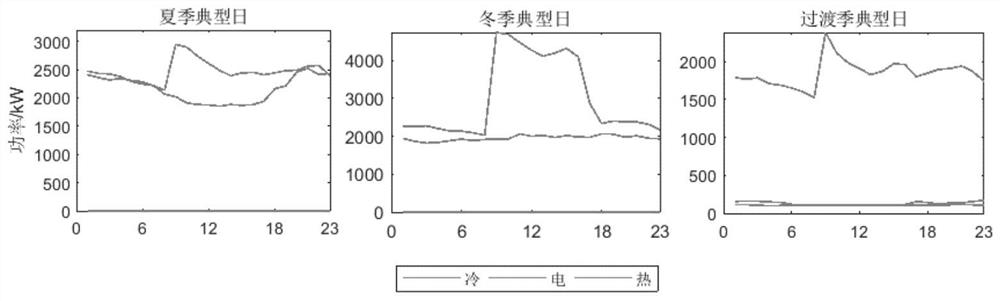

Method for establishing comprehensive energy planning and operation joint optimization model

PendingCN111899120AExcellent economic indexRun reasonablyData processing applicationsDesign optimisation/simulationOperation schedulingIntegrated energy system

The invention discloses a method for establishing a comprehensive energy planning and operation joint optimization model, which comprises the following steps of: unifying park equipment type selectionand operation scheduling optimization, performing joint optimization, and selecting an investment planning scheme with better economy by taking the minimum annual comprehensive cost as a target function. Equipment model selection is carried out in the planning stage, different types of equipment are mutually combined to form different planning schemes, and alternative planning schemes meeting theload standard are screened out by taking meeting the maximum load requirement of the park as a hard condition; in the operation optimization stage, for each alternative planning scheme, optimizationcalculation is carried out according to different equipment capacity configurations; and finally, comprehensively considering the cost expenditure situation in the planning and operation process, andselecting an investment planning scheme with better economy by taking the minimum annual comprehensive cost as a target function. According to the method, comprehensive energy system planning and operation control are associated, so that park operation optimization is more comprehensive and reasonable, and a planning operation scheme with better economic indexes is obtained.

Owner:STATE GRID ZHEJIANG ELECTRIC POWER +2

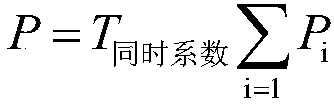

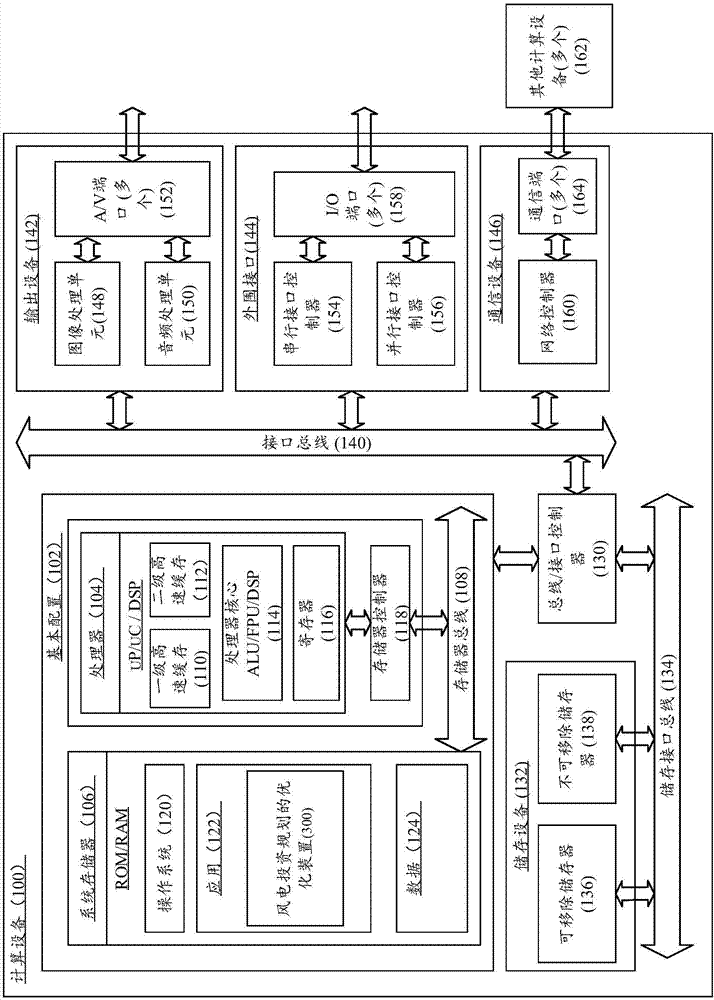

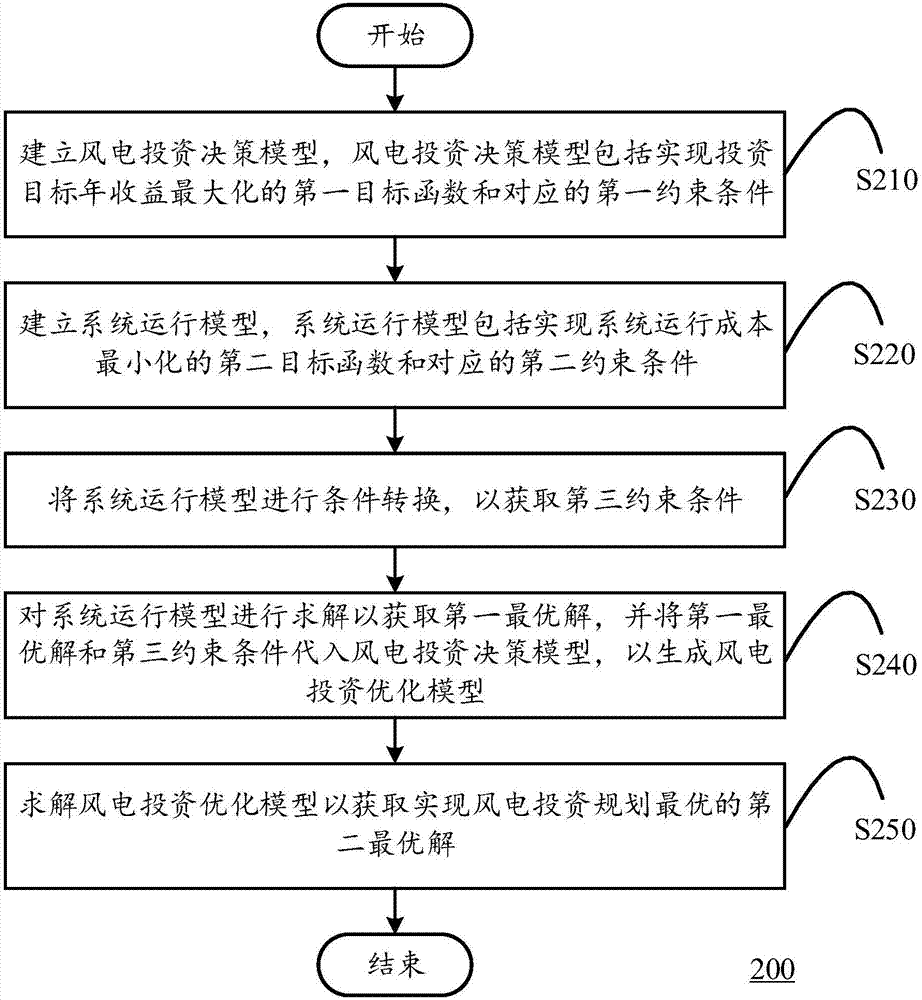

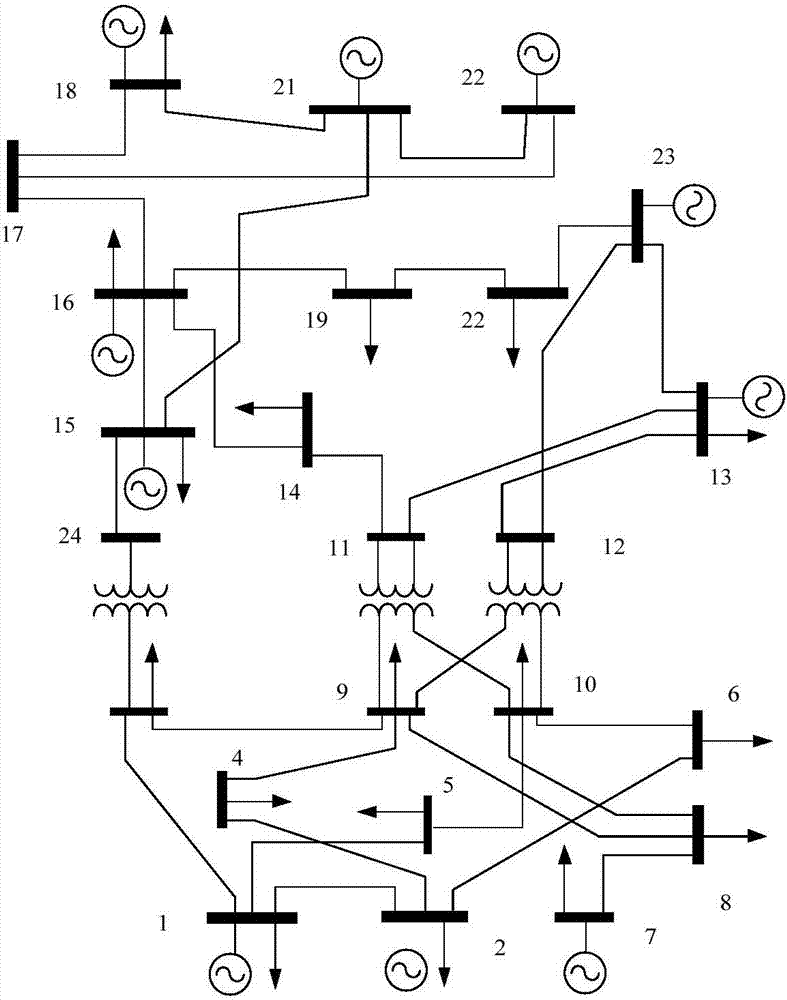

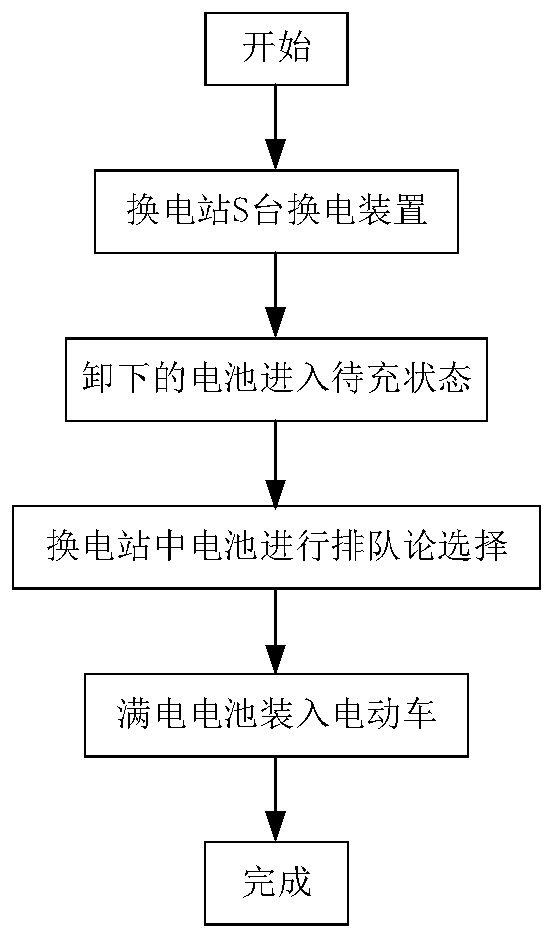

Optimization method and device for wind power investment planning and computing equipment

ActiveCN107147116AImprove reliabilityImprove accuracyForecastingSystems intergating technologiesElectricityDecision model

The invention discloses an optimization method and device for wind power investment planning and computing equipment. The method comprises the following steps: building a wind power investment decision model, wherein the wind power investment decision model includes a first target function for realizing annual profit maximization of an investment objective and a corresponding first constraint condition; building a system running model, wherein the system running model includes a second target function for realizing system running cost minimization and a corresponding second constraint condition; performing conditional transition on the system running model to obtain a third constraint condition; solving the system running model to obtain a first optimal solution, and substituting the first optimal solution and the third constraint condition into the wind power investment decision model in order to generate a wind power investment optimization model; and solving the wind power investment optimization model in order to obtain a second optimal solution for realizing optimal wind power investment planning.

Owner:STATE GRID JIANGSU ECONOMIC RES INST +3

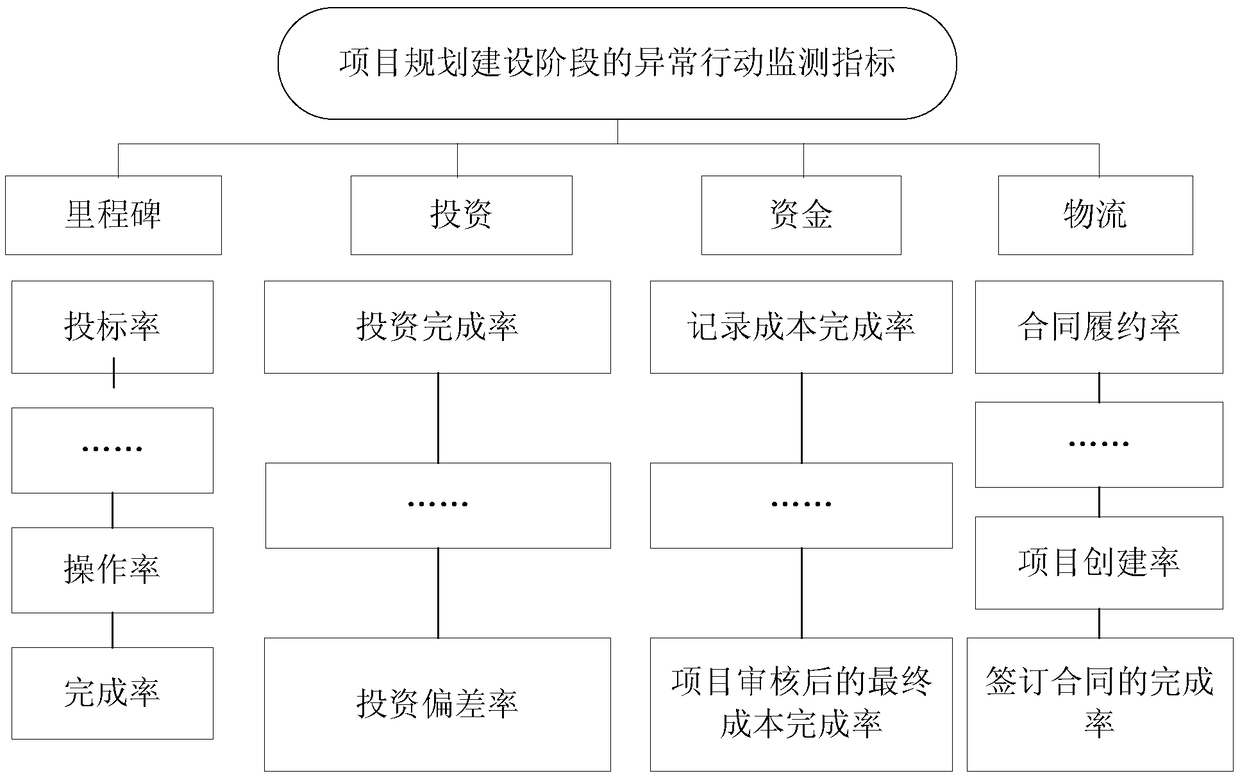

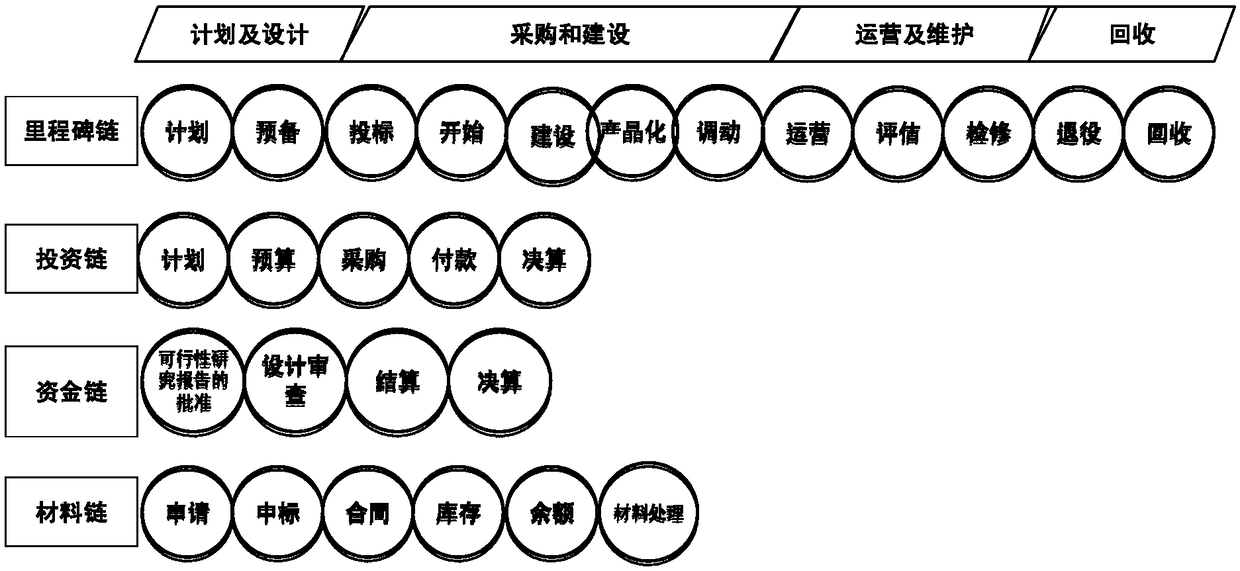

A power grid project management method and a system based on a two-way risk identification model

The invention relates to a power network project management method and system based on a two-way risk identification model, which comprises the following steps: for a single power network project, monitoring construction and operation progress according to abnormal action monitoring indicators in a pre-constructed power network project life cycle monitoring control index system; and monitoring theabnormal action monitoring indicators in a power network project life cycle monitoring control index system. According to the pre-constructed two-way risk identification model, the executive layer identifies the abnormal action risk of the power grid project and alarms the abnormal items. Reporting alerts to management and strategy in turn; combined with the alarm information, the problem of abnormal item execution process is tracked, the detailed abnormal behavior is found, the abnormal reason is analyzed, and the problem is solved in time. Send feedback to the strategy layer to provide support and reference for project planning, investment planning, budget planning, etc. The invention realizes the quick capture of the management risk of the power grid project, contributes to the accurate investment strategy and the improvement of the enterprise performance, and provides the theoretical and technical support for the whole chain management control of the power grid project.

Owner:STATE GRID ECONOMIC TECH RES INST CO +3

Creating and maintaining a payout-ready portfolio within an investment plan to generate a sustainable income stream

Financial advisory methods and systems for creating a steady lifetime income stream within an investment plan is provided. According to one embodiment, based on an investor's current holdings in the investment plan, a pattern of periodic cash payouts is identified that can be made to the investor from an in-plan payout program implemented with the limited universe of financial products available within the investment plan. The assets of the investment plan are rebalanced to form a payout portfolio and an equity exposure portfolio. The payout portfolio is constructed to create an annuity-like stream of income to support the pattern of periodic cash payouts and includes multiple bond funds. The equity exposure portfolio is constructed to address inflation risk by providing an ability to rise with equities markets. Finally, a periodic cash payout of the pattern of periodic cash payouts is caused to be paid to the investor from the investment plan.

Owner:EDELMAN FINANCIAL ENGINES LLC

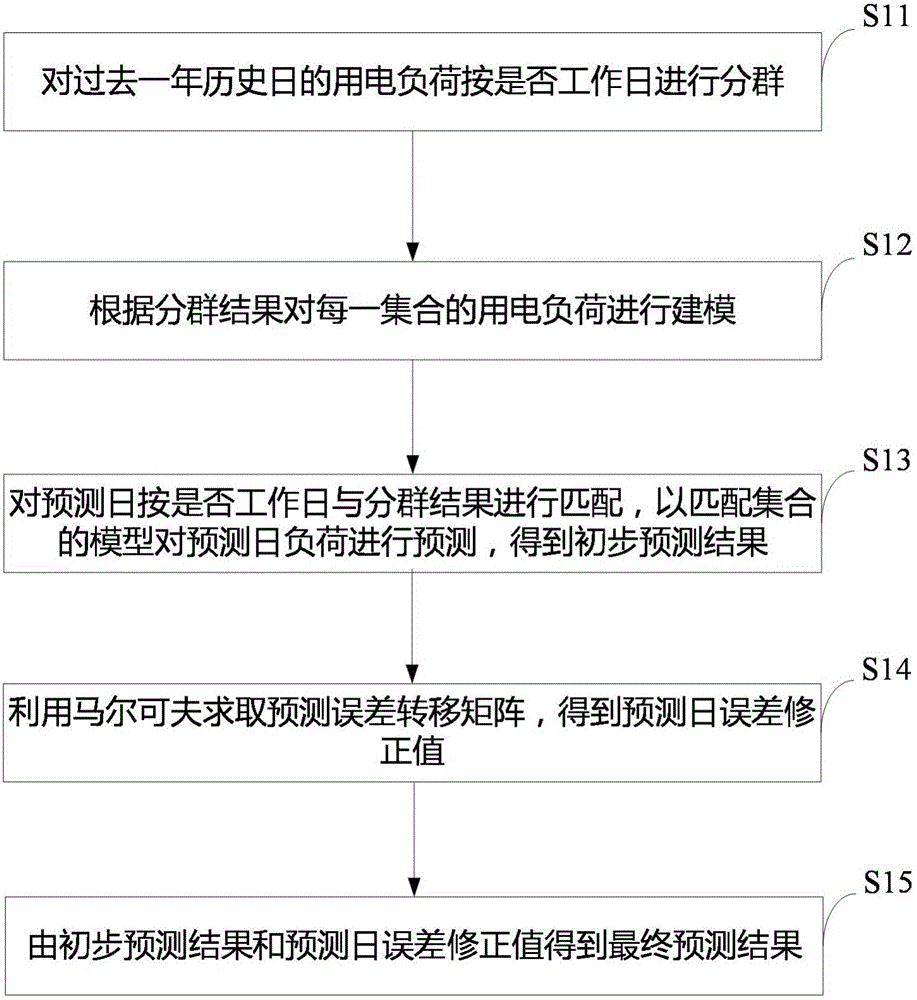

Modeling method of power use load prediction system for power client

The invention discloses a modeling method of a power use load prediction system for a power client. The method comprises a step of grouping the power use loads of the historical days of several past years into a working day group and a non-working-day group, a step of modeling the power use loads of the working day group and a non-working day group according to the grouping result, a step of matching prediction days with the grouping result according to working days and non-working days so as to matching the model of a corresponding set to predict the prediction day load to obtain a preliminary prediction result, a step of obtaining a prediction day error correction value by using a Markov calculation prediction error transfer matrix, and a step of obtaining a final prediction result by the preliminary prediction result and the prediction day error correction value. According to the method, the prediction of the power use load is realized, a basis is provided for the investment planning of a power grid, and the working efficiency of the power grid is improved.

Owner:MERIT DATA CO LTD

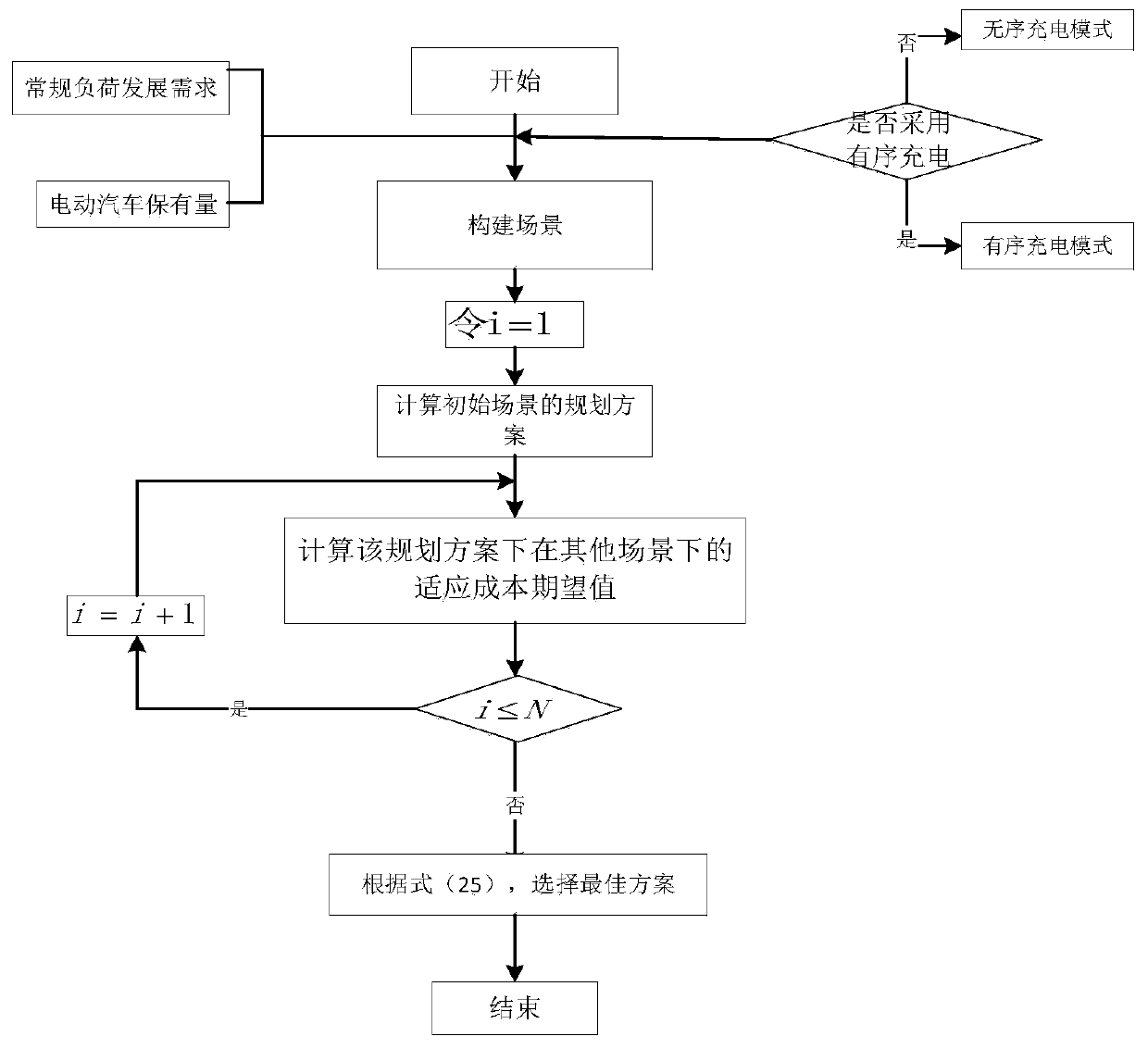

Flexible planning method of power distribution system suitable for large-scale application of electric automobile

ActiveCN110796286AReduce construction costsLow running costForecastingResourcesControl engineeringElectric vehicle

The invention discloses a flexible planning method of a power distribution system suitable for large-scale application of an electric automobile. The method comprises: based on the minimum sum of investment and operation costs, establishing a power distribution system expansion planning model, and giving a charging load calculation method in a disordered and ordered charging mode; on the basis, considering various uncertain factors such as loads in the system, applying a scene analysis technology, forming a scene by three vectors such as a conventional load predictive quantity, an electric vehicle ownership quantity and a charging mode, and obtaining a solution through an effective optimization solver GUROBI, so that a flexible planning model of the power distribution system is obtained; and finally, explaining the proposed model and strategy by using an example. According to the method, an initial construction scheme with low cost can be provided for investors, the adaptability of thescheme to other possible scenes in the future is achieved, and certain risks are reduced for future investment planning of the investors.

Owner:国网山西省电力公司经济技术研究院 +2

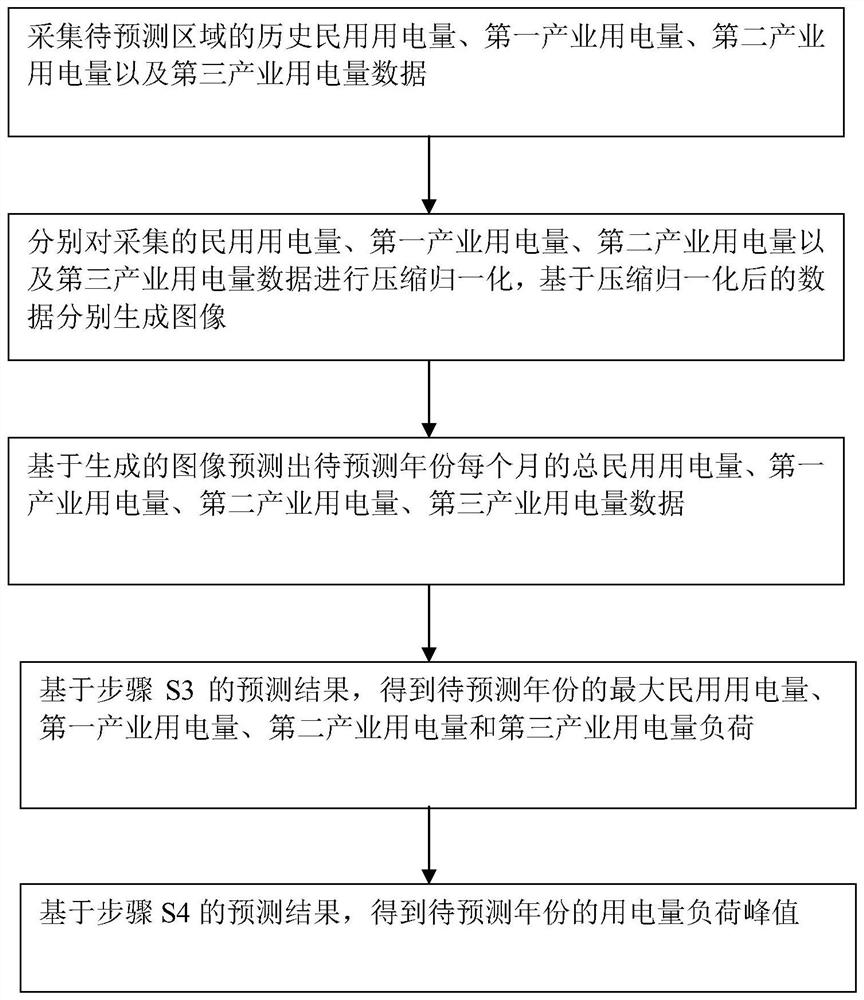

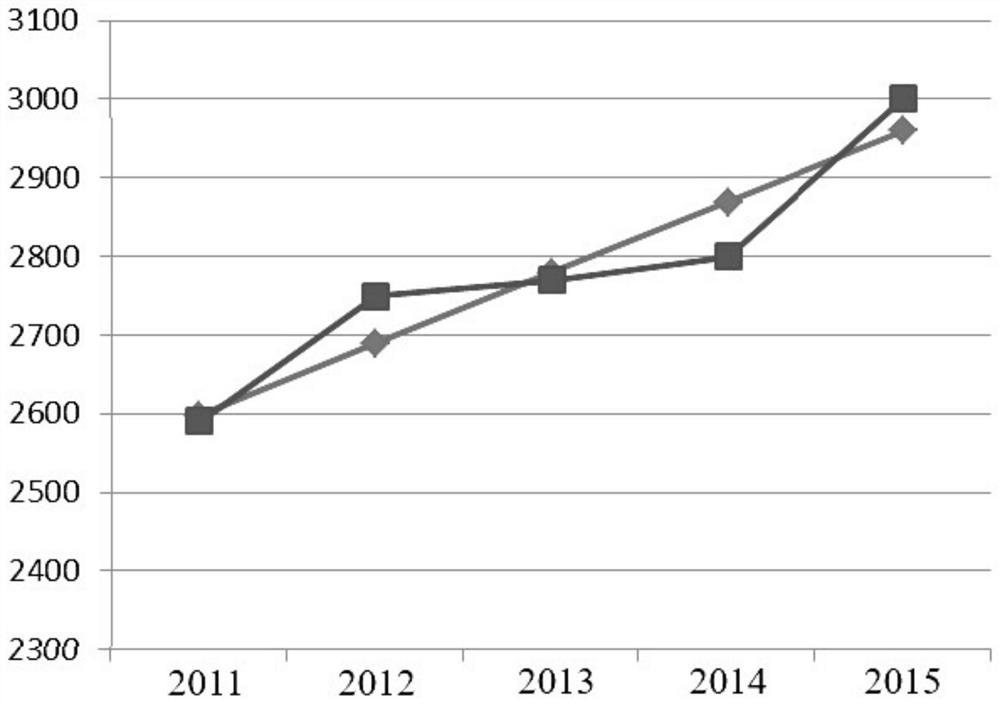

Intra-region electrical load peak prediction method and power grid investment planning method

ActiveCN113610296AImplement classification predictionImprove accuracyLoad forecast in ac networkForecastingElectric consumptionPower usage

The invention discloses an intra-region electrical load peak prediction method and a power grid investment planning method, and relates to the technical field of power grid investment planning. The invention aims to solve the problems of low prediction accuracy and poor prediction reliability of the existing electrical load peak prediction method. The method comprises the following steps: firstly, classifying and compressing and normalizing collected historical electricity consumption data , and generating a grayscale image based on a compressed and normalized value; and then inputting the generated grayscale image into a convolutional neural network in a month-based and classified manner to realize classified prediction of the power consumption load; and finally, summing the maximum power consumption load of each type to obtain a power consumption load peak value of the year to be predicted. Compared with an existing method, the power consumption load peak prediction accuracy and reliability can be remarkably improved, and the effectiveness of the power grid capital construction scale and the power grid investment planning is improved. The method is mainly used for predicting the electrical load peak value.

Owner:国网黑龙江省电力有限公司经济技术研究院 +1

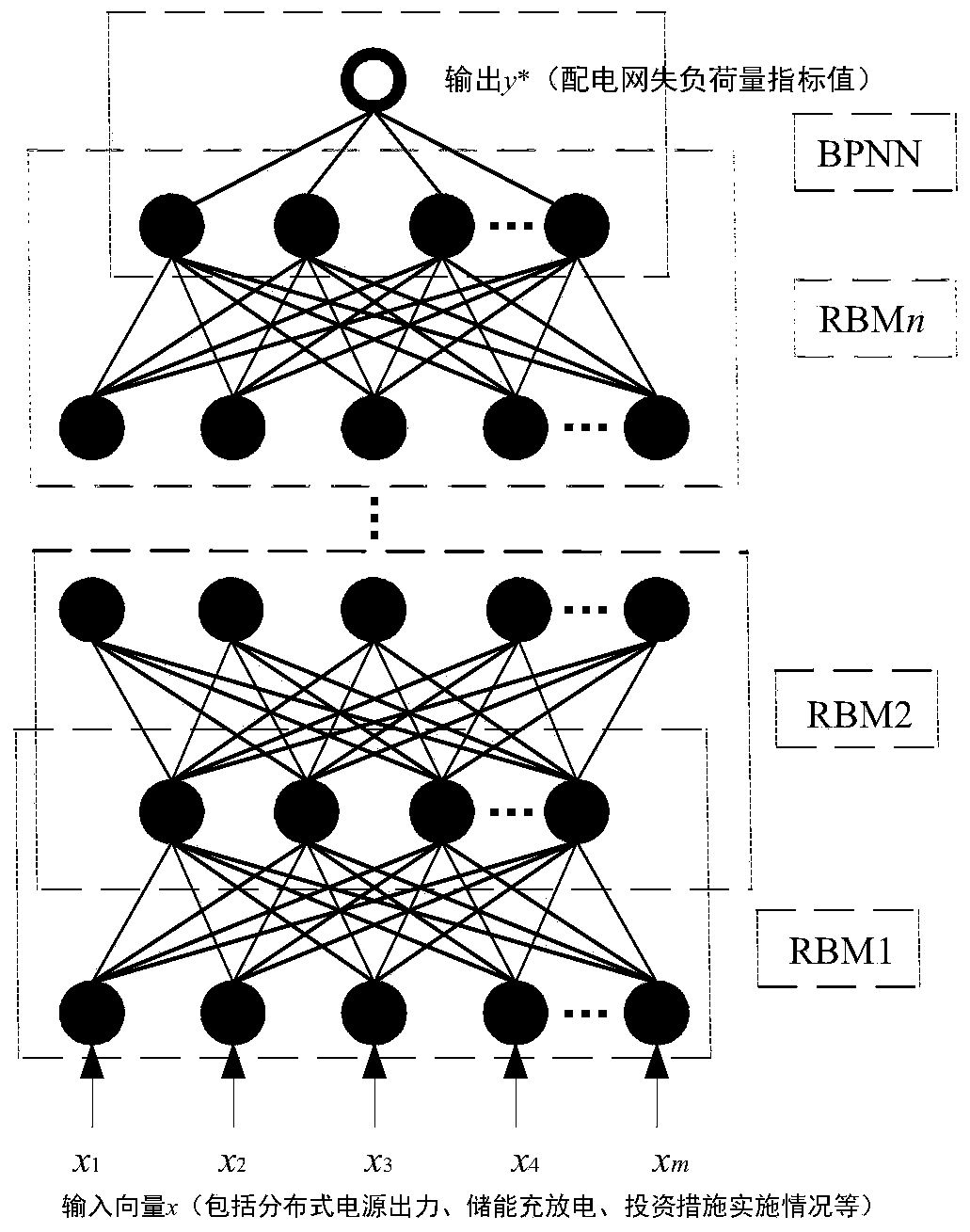

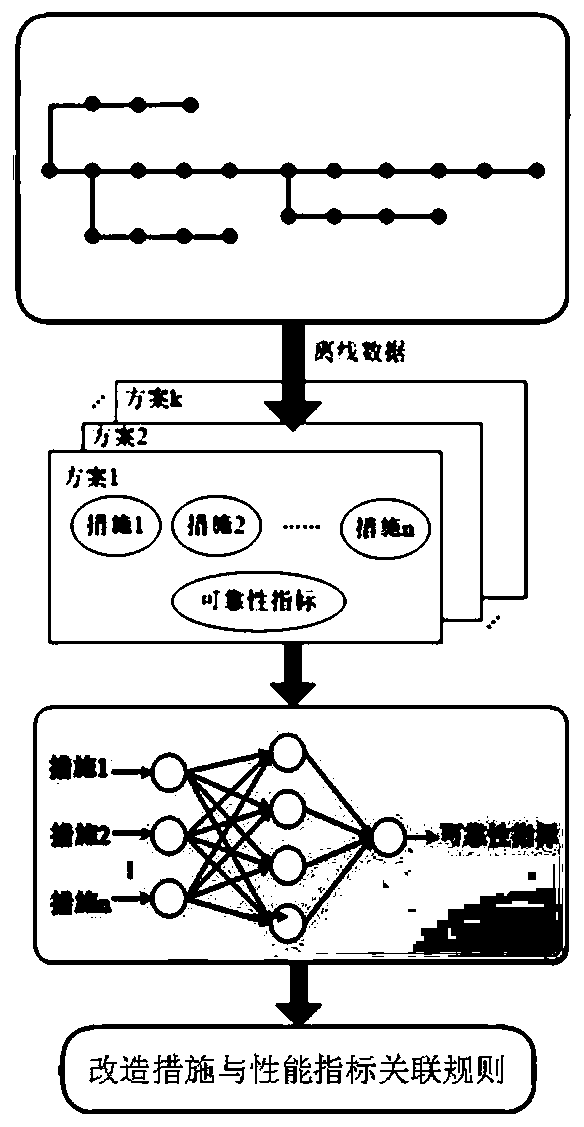

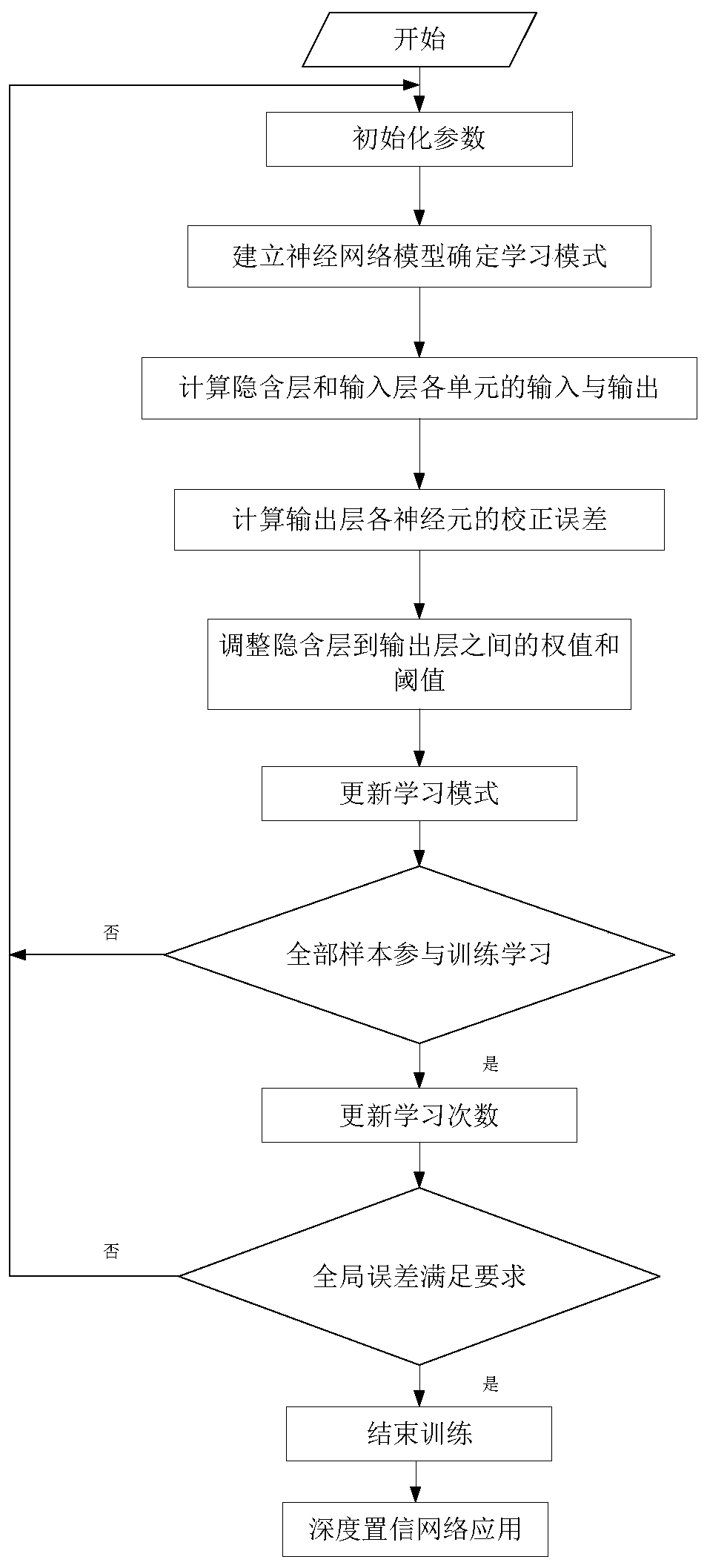

Power distribution decision modeling method based on relevance between transformation measures and load loss indexes

PendingCN111415068AReduce time consumptionRealize precise investment planning decisionsNeural architecturesResourcesDeep belief networkOffline learning

The invention relates to the technical field of power systems, and provides a multi-year investment planning decision-making modeling technology based on relevance between power distribution network reconstruction measures and power grid load loss capacity indexes in order to solve the problem of complex load flow calculation involved in traditional power distribution network investment decision-making modeling and consider improvement of operation reliability indexes of a current power distribution network. According to the modeling technology, through the data mining technology, the investment decision model has great advantages in the aspects of finding problem potential rules, improving the calculation efficiency and the like, the complex load flow calculation process can be avoided, and the calculation efficiency is effectively improved. A training sample set is formed by load loss indexes and transformation measures, and corresponding association relationship rules can be obtained through offline learning of sample data and serve as the basis of a multi-year investment decision-making model. In practical application, when a reconstruction measure configuration scheme is given, the deep belief network model can quickly give a result of a load loss index as a constraint condition of a subsequent power distribution network investment decision model.

Owner:XIAMEN ELECTRIC POWER SUPPLY COMPANY OF STATE GRID FUJIAN ELECTRIC POWER +1

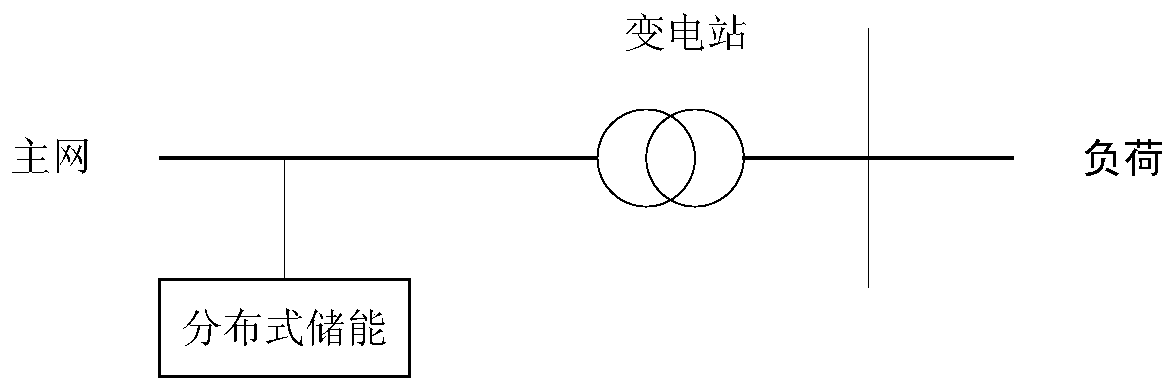

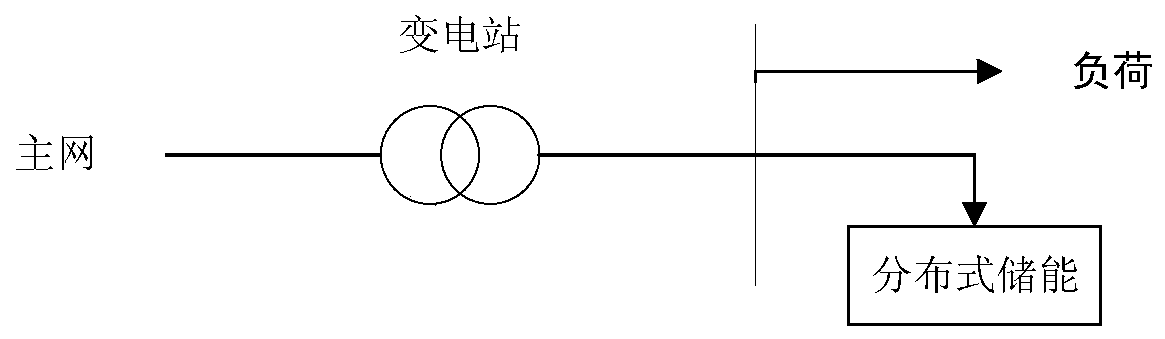

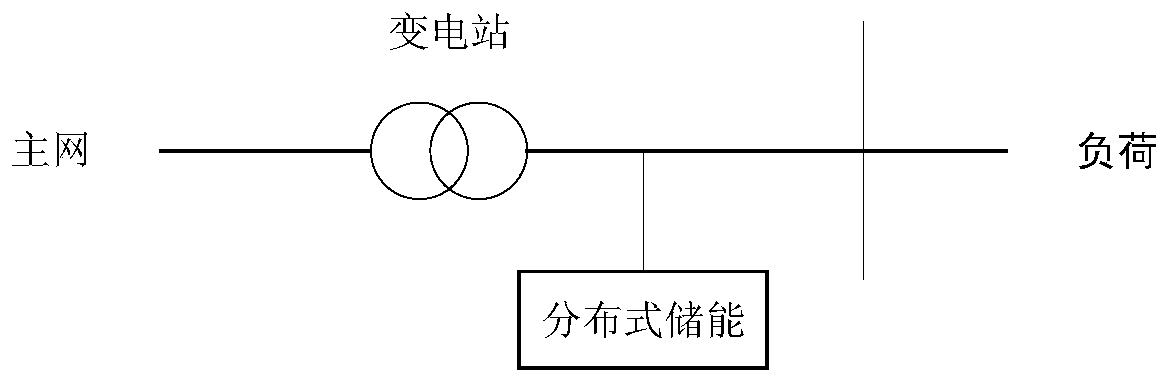

Distributed energy storage investment planning model construction method considering full life cycle benefits

The invention discloses a distributed energy storage investment planning model construction method considering full life cycle benefits, which comprises the following steps: 1) obtaining the application value of distributed energy storage in different application scenes based on the technical characteristics of distributed energy storage; 2) analyzing and obtaining each cost of the distributed energy storage in the whole life cycle, 3) establishing a distributed energy storage whole life cycle benefit model by combining the application value of the distributed energy storage and each cost in the whole life cycle; 4) based on the distributed energy storage full life cycle benefit model, establishing a distributed energy storage investment planning model by taking the maximum benefit as a target; and 5) setting an objective function and a constraint condition of investment planning in different application scenes of the distributed energy storage to obtain the distributed energy storageinvestment planning method considering the full life cycle benefit. The distributed energy storage investment planning method is obtained on the basis of the application value of distributed energy storage in the same application scene and various costs in the whole life cycle.

Owner:STATE GRID SICHUAN ECONOMIC RES INST

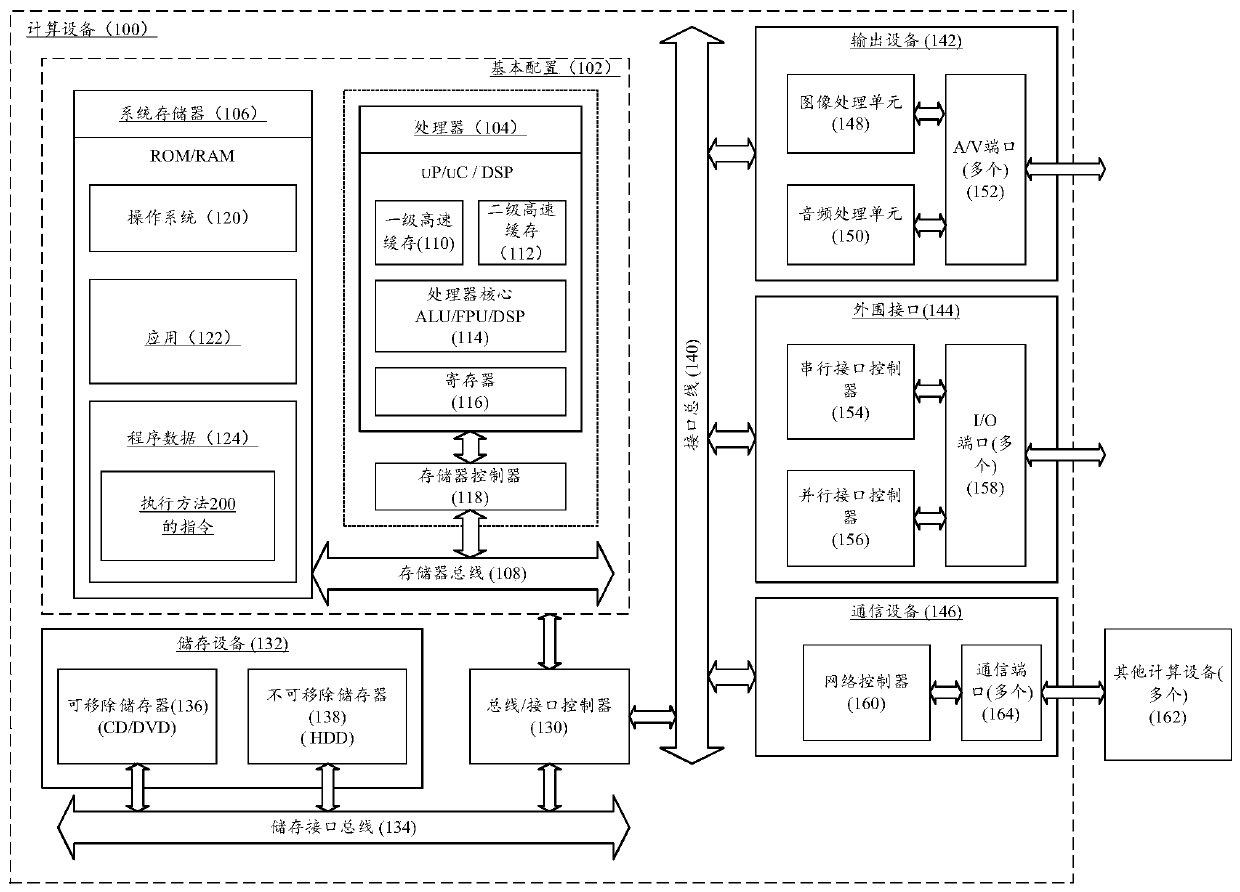

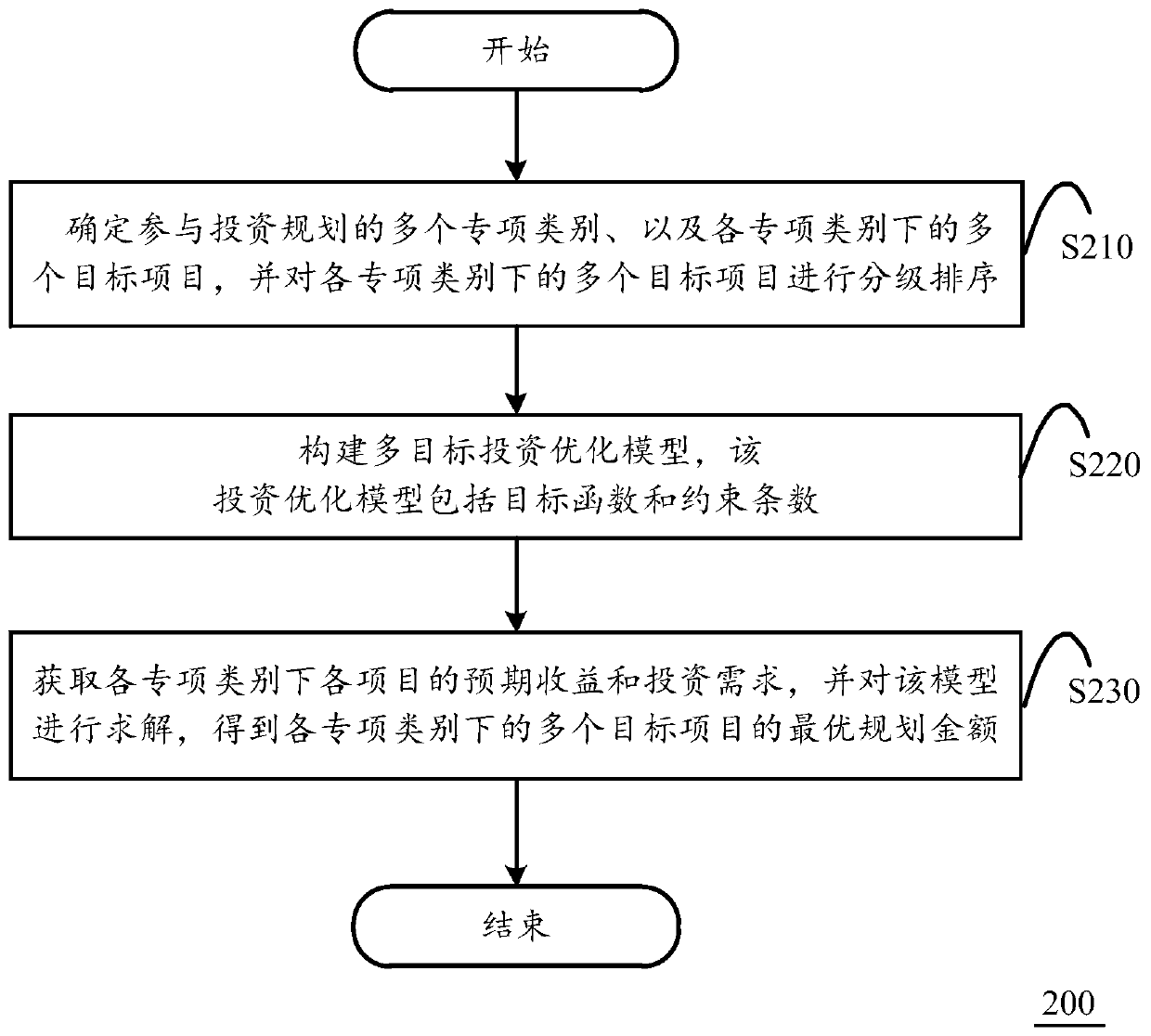

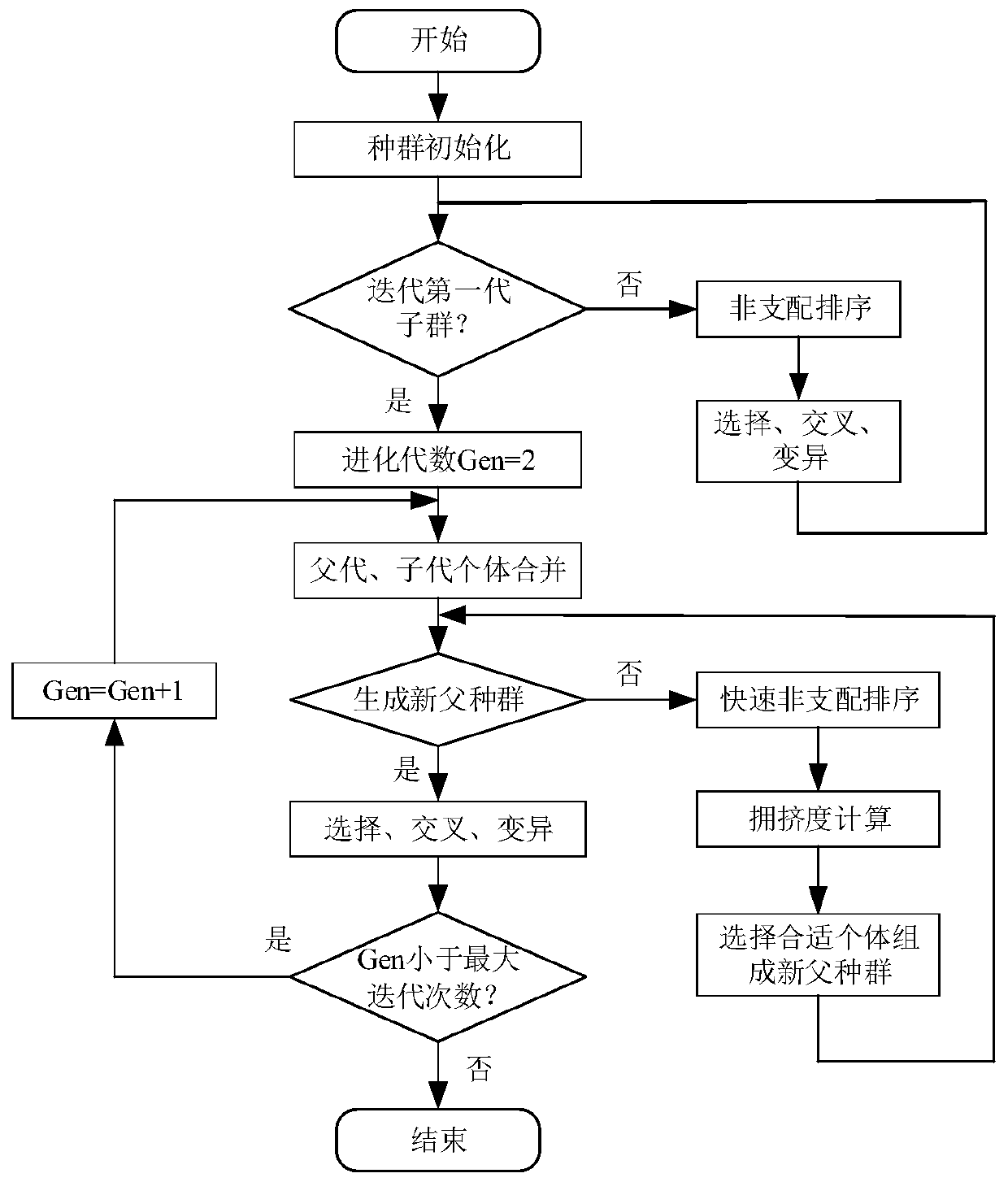

Construction method and device of multi-target investment optimization model and calculation equipment

InactiveCN110796296AImprove ranking accuracyMarket predictionsForecastingInvestment planningOperations research

The invention discloses a construction method of a multi-target investment optimization model, which is suitable for being executed in calculation equipment, and comprises the following steps of: determining a plurality of special categories participating in investment planning and a plurality of target projects under each special category, and grading and sequencing the plurality of target projects under each special category; constructing a multi-objective investment optimization model, wherein the model comprises an objective function and a constraint number, and the objective function comprises the maximum expected revenue total amount of the total company full-category project, the minimum difference between the actual deduction funds of the sub-companies and the investment demand, and the minimum difference between the actual deduction funds of the special items and the planning investment demand of the sub-companies; and obtaining the expected revenue and investment demand of each project under each special category, and solving the multi-target investment optimization model by adopting a predetermined algorithm to obtain the optimal planning amount of the sorted target projects under each special category. The invention further discloses a corresponding multi-target investment optimization model construction device and calculation equipment.

Owner:STATE GRID ECONOMIC TECH RES INST CO +2

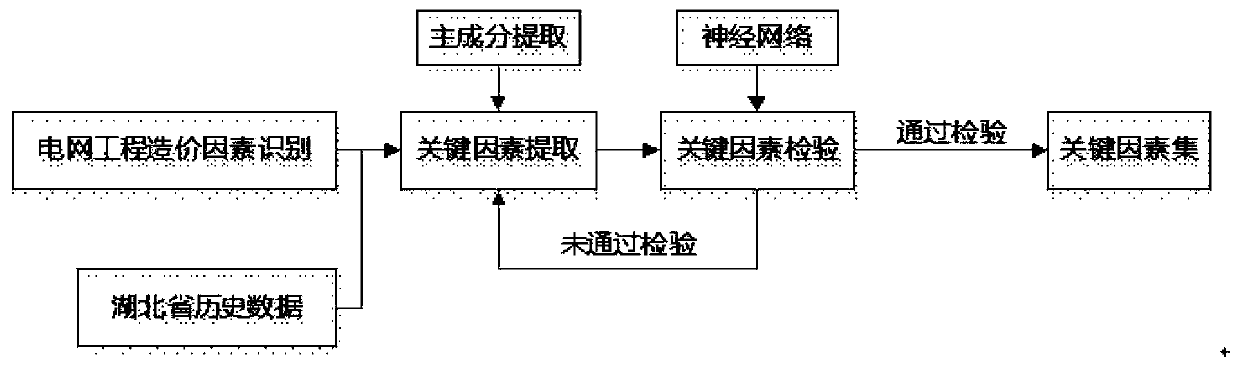

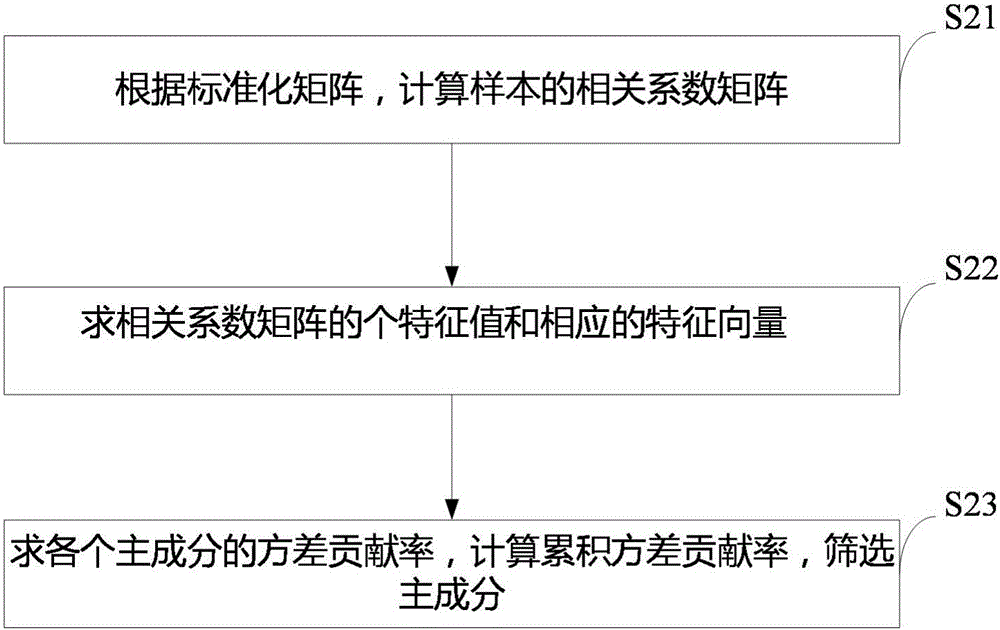

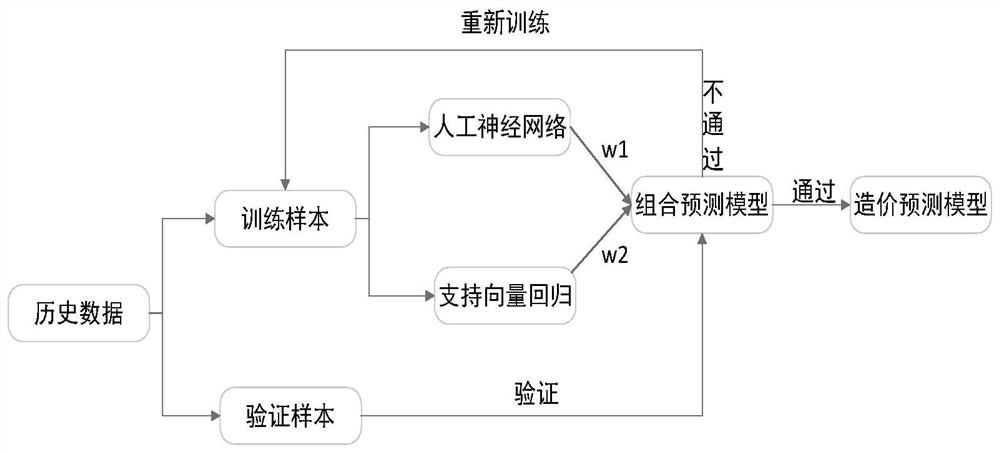

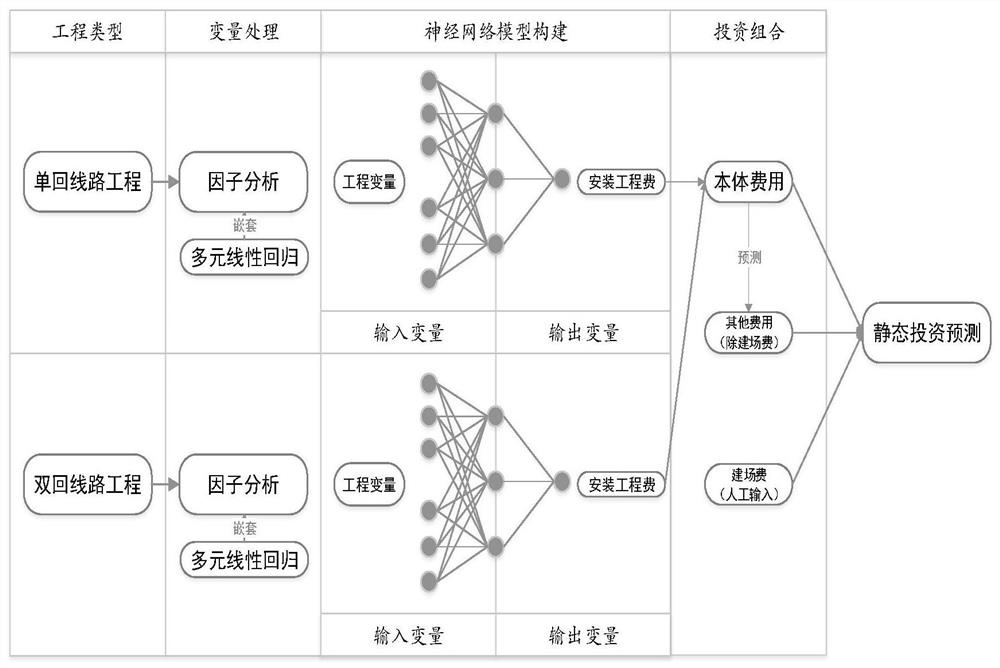

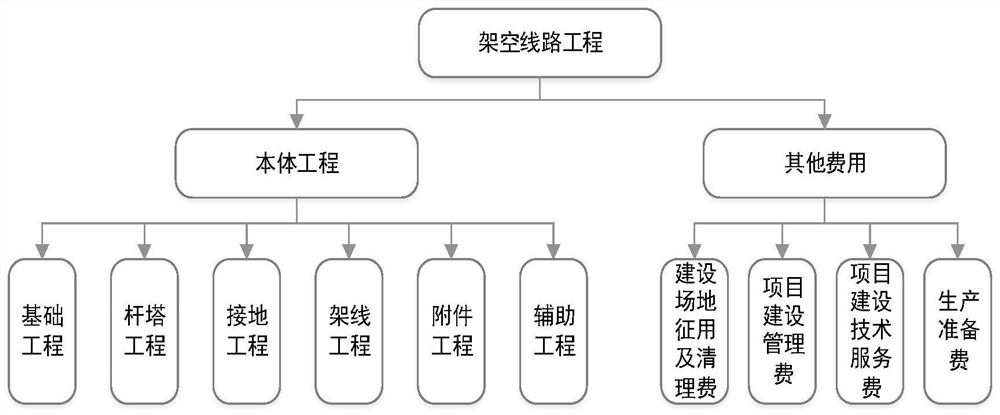

Construction method of cost prediction model based on overhead line project

InactiveCN112801687AFew influencing factorsMeet the needs of cost forecast dimension refinementMarket predictionsCharacter and pattern recognitionPrincipal component analysisCost prediction

The invention discloses an overhead line project-based cost prediction model construction method. The method comprises the following steps of: selecting historical cost data of an overhead line project which is completed and put into production within 2-3 years for analysis; on the basis of analyzing main influence factors of overhead line project cost, a data basis is provided for model construction through a principal part analysis method; enabling the training sample data to form a combined prediction model through an algorithm of support vector regression W2 and an algorithm of an artificial neural network W1; if the combined prediction model passes prediction result analysis, obtaining a cost prediction model; in the initial stage of project construction, key factors of a to-be-predicted project are input through the cost prediction model, and a cost prediction value of the project can be obtained. According to the method, the optimized intelligent prediction model is verified, a certain prediction capability is provided for the prediction model of the cost of each sub-item of the new project, and the prediction result is relatively accurate. And the investment prediction work in the project front-end investment plan compilation can be assisted.

Owner:CENT SOUTHERN CHINA ELECTRIC POWER DESIGN INST CHINA POWER ENG CONSULTING GROUP CORP

System and method for informing a recipient of a contribution of an investment gift

A method and system for informing a recipient of an investment gift. The system includes a financial institution providing investment plans to an investor. The system also includes an information provider providing messages to the financial institution for use in informing a recipient of an investment gift. The financial institution offers the messages to the investor providing an investment gift to a recipient. The message is sent by the investor to the recipient to inform the recipient of an investment gift. The system and associated method allows the financial institution to promote the sale of investment gifts and informs the recipient of the investment gift the details of the investment gift.

Owner:MORNING STAR MARKETING

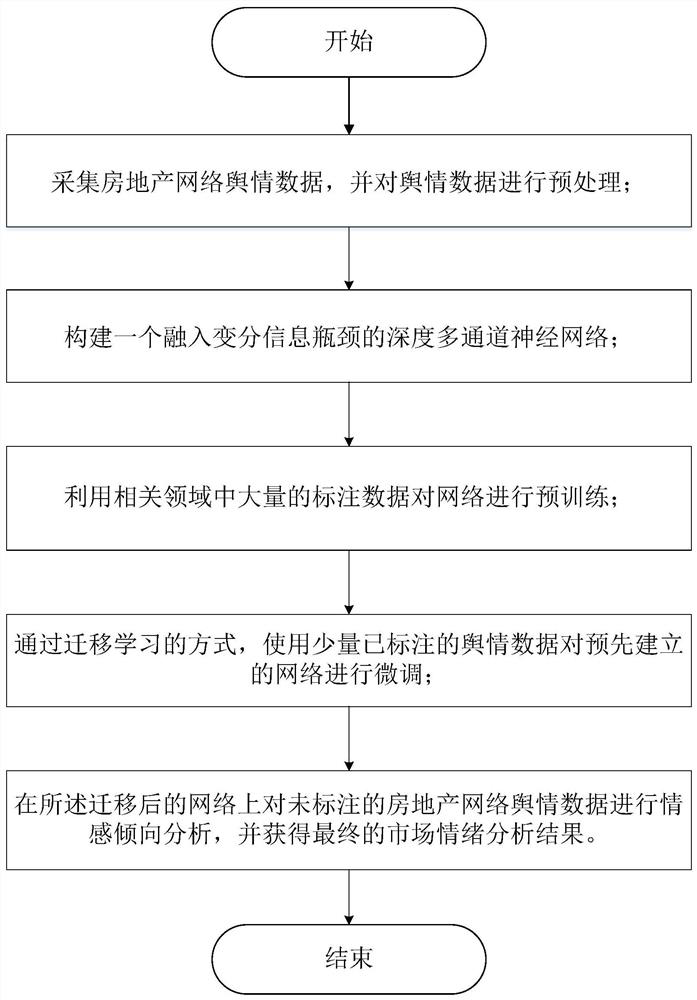

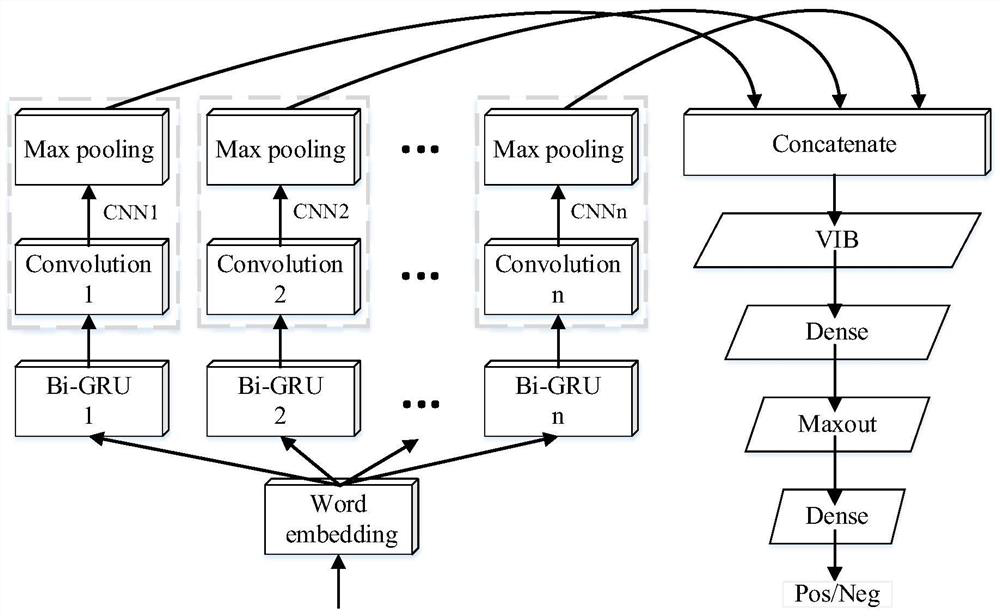

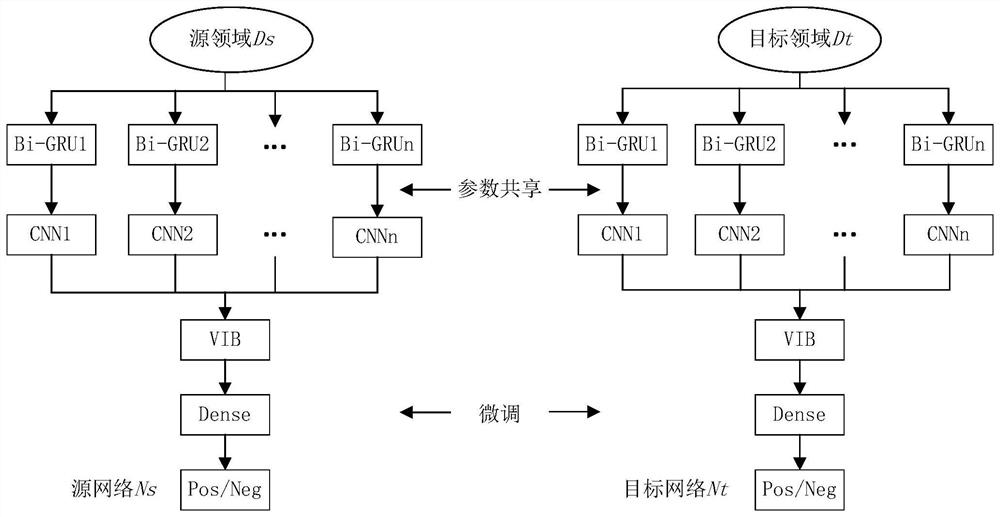

Real estate market analysis method and device based on deep transfer learning and equipment

ActiveCN111813893ASolve the problem of prone gradient disappearanceAccurate understandingWeb data indexingSemantic analysisBusiness enterpriseInvestment planning

The invention belongs to the field of natural language processing and sentiment analysis, and particularly relates to a real estate market analysis method and device based on deep transfer learning, and equipment, and the real estate market analysis method comprises the steps: collecting real estate network public opinion data, and carrying out the preprocessing of the public opinion data; constructing a deep multi-channel neural network integrated with a variational information bottleneck; pre-training the network by using a large amount of annotation data in the related field; finely adjusting a pre-established network by using a small amount of marked public opinion data in a transfer learning mode; and performing emotional tendency analysis on unlabeled real estate public opinion dataon the migrated network, and obtaining a final real estate market emotional analysis result. According to the real estate market analysis method, deep migration learning and real estate network publicopinions are combined, and real estate market emotion can be accurately analyzed, so that reference and guidance are provided for policy making of related departments, decision deployment of companies and enterprises and investment planning of individual consumers.

Owner:芽米科技(广州)有限公司

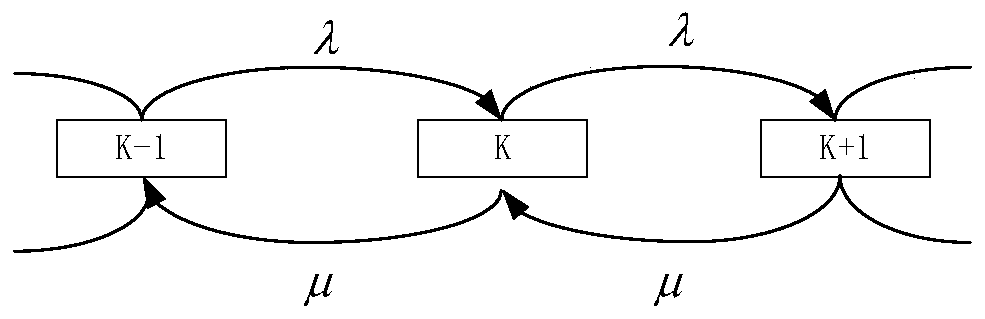

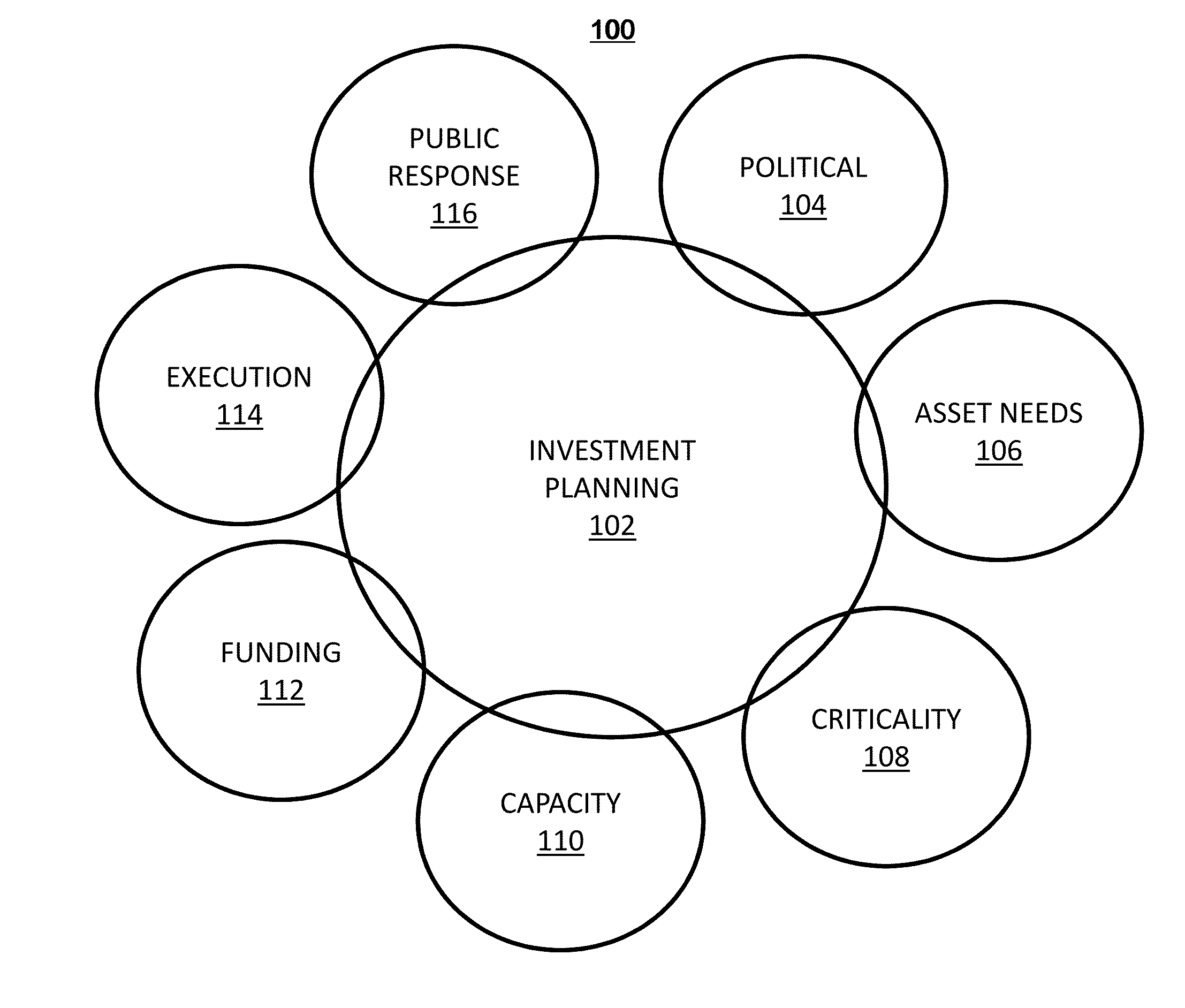

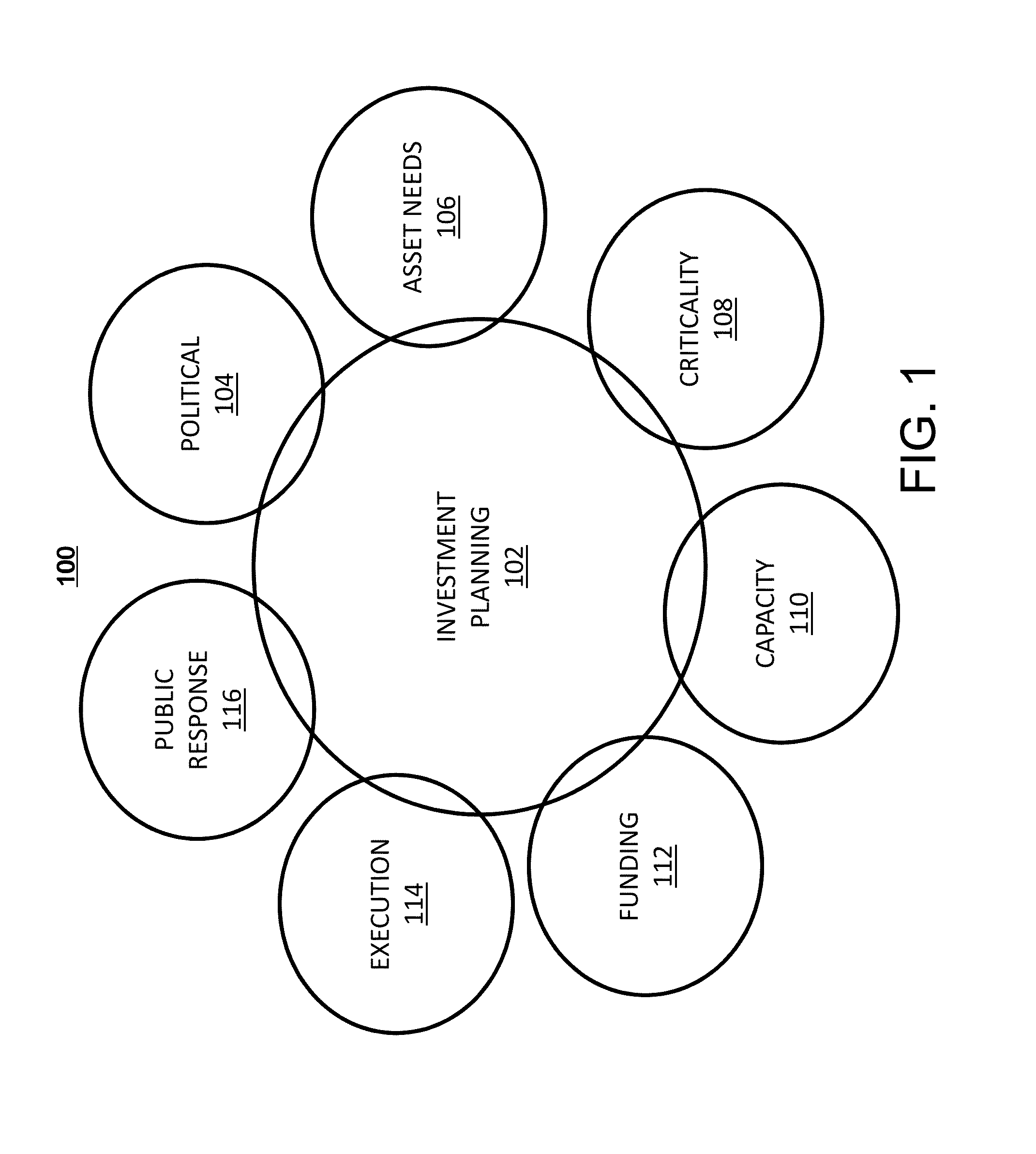

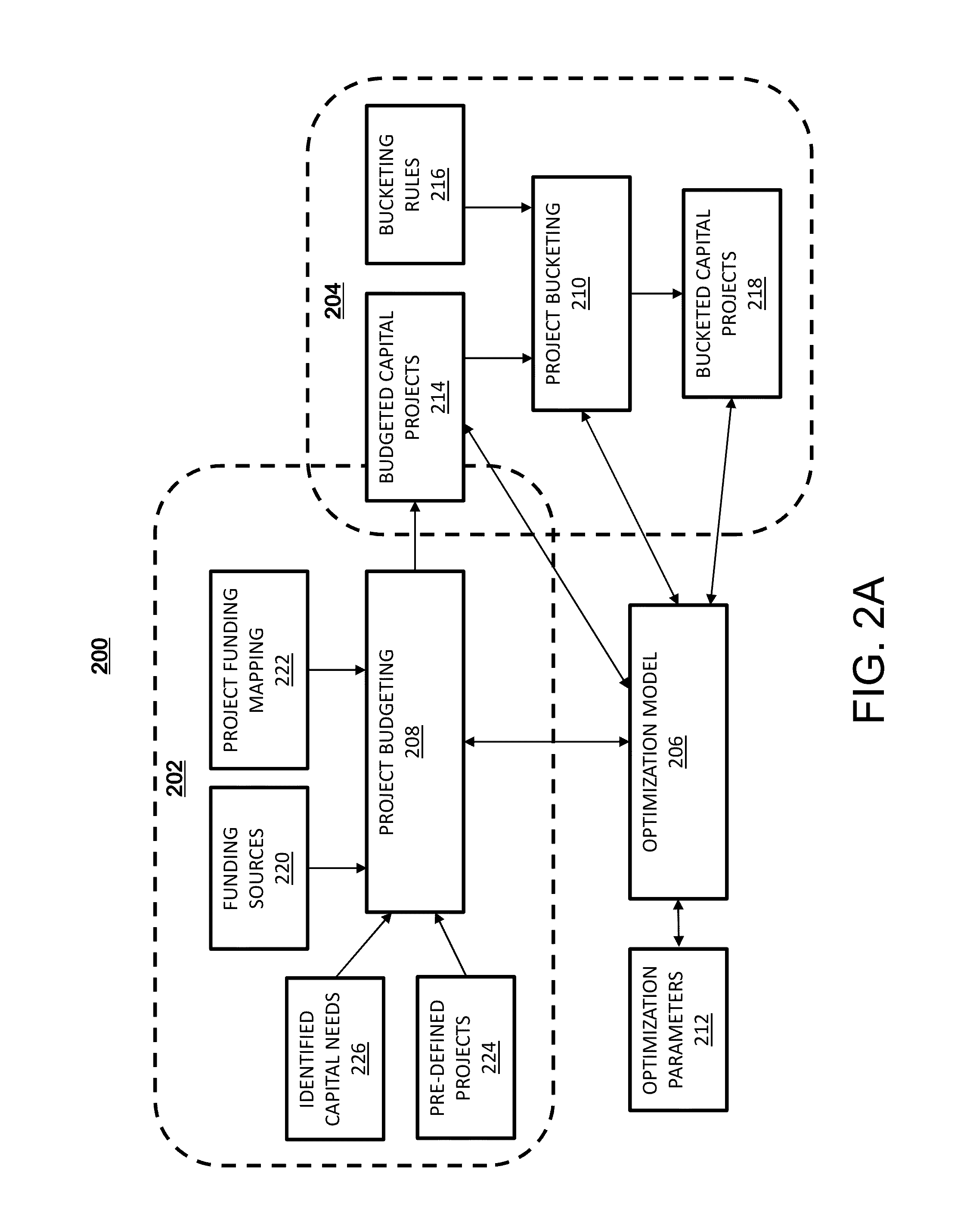

Stochastic investment planning system

Embodiments relate to stochastic investment planning. One aspect includes receiving a plurality of constraints associated with projects to be performed by a plurality of agencies. The constraints are compared across the projects to identify projects having a spatial overlap and compatible project types. Two or more of the projects are combined based on compatibility of the projects having the spatial overlap. An optimization model is applied to the combined projects to produce an optimization parameter representing a critical attribute based on at least one uncertainty of the combined projects. The comparing, the combining, and the applying of the optimization model are iteratively repeated while varying a threshold for combining the projects until the optimization parameter is determined to be within an acceptable range.

Owner:IBM CORP

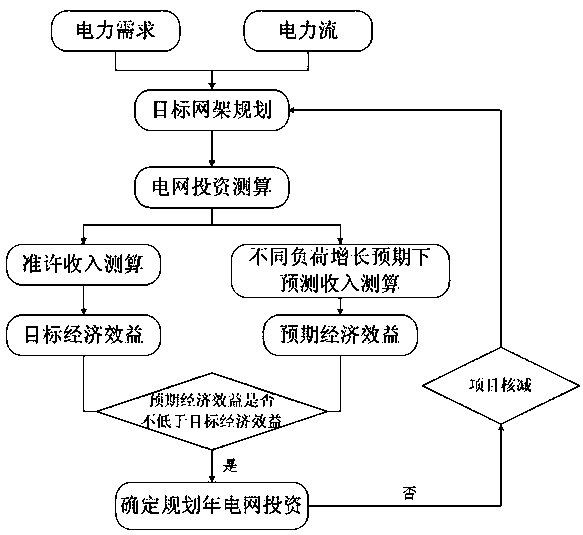

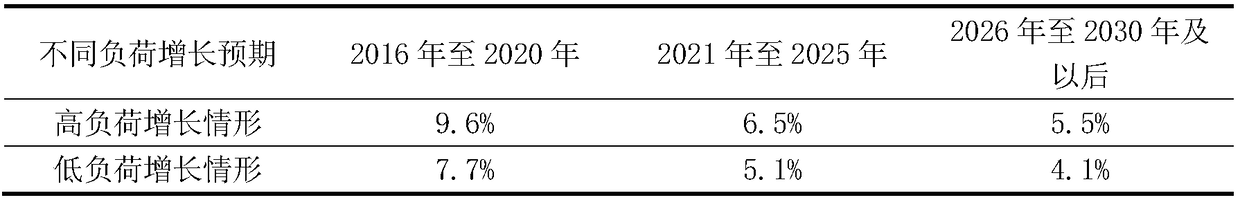

A method of grid investment planning guaranteeing permissible revenue availability

A method of grid investment planning guaranteeing permissible revenue availability is provided. By taking the power demand and power flow of regional power network in planning year as boundary conditions, the power system analysis integrated program is used to program the target grid structure, the investment in power network planning is estimated, so that the investment is based on the power network plan; the economic benefits corresponding to the permitted revenue model and the predicted revenue model in the whole operation period are calculated respectively; then, with the economic benefitcorresponding to the permitted income as the objective, if the economic benefit corresponding to the forecasted income is not lower than the target, it is considered that the investment in power network planning can guarantee the income of the enterprise; otherwise, the long-term project is partially reduced and the target grid structure planning is carried out again until the economic benefit corresponding to the forecasted income is not lower than the target, and the investment corresponding to the target grid structure planning is taken as the result of the power network investment planning. The planning method of this design has clear logical thinking, reliable data source and strong maneuverability, and can accurately carry out the power network investment planning calculation.

Owner:STATE GRID CORP OF CHINA +1

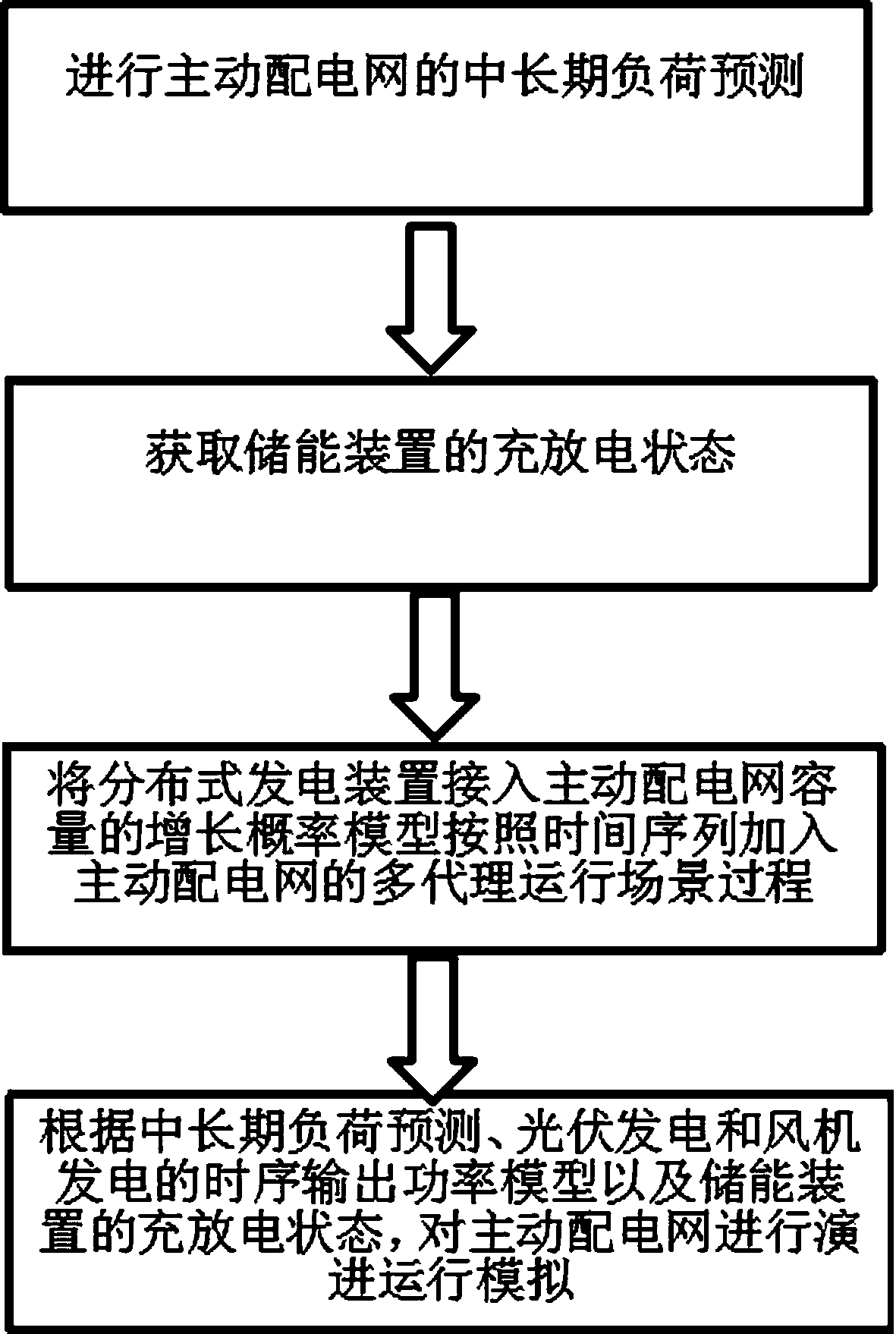

Simulation method for operation time sequence of active power distribution network

ActiveCN108695848AGood autonomyImprove adaptabilityAc network circuit arrangementsSimulationCorrelation analysis

The invention discloses a simulation method for an operation time sequence of an active power distribution network, and the method comprises the steps: performing medium- and long-term load predictionof the active power distribution network; establishing a growth probability model of the access capacity of a distributed generation device; respectively establishing tie sequence output power modelsof photovoltaic power generation and wind turbine power generation in the active power distribution network; obtaining the charging and discharging states of an energy storage device according to themedium- and long-term load prediction of the active power distribution network and the output powers of photovoltaic power generation and wind turbine power generation; selecting an interactive operation strategy of the active power distribution network with high economic benefit, performing the simulation of the evolution operation of the active power distribution network in a process that the growth probability model of the access capacity of the distributed generation device is added to an operation scenario of the active power distribution network according to the time sequence, and generating an active power distribution network time sequence operation sample which meets the operation balance constraint and includes the growth probability. The method can be effectively used for the correlation analysis of technical paths and indicators in the subsequent active power distribution network investment planning.

Owner:STATE GRID FUJIAN ELECTRIC POWER CO LTD +3

Real estate investment calculation method

InactiveCN106204281AAccurate Checking AccuracyIntuitive displayFinanceProgram planningInvestment planning

The invention discloses a real estate investment calculation method. The method includes the following steps: S1. selecting a land investment calculation plan and performing calculation; S2. calculating a floor transaction price and a land transaction price, and calculating a capacity building area and a non-capacity building area; S3. performing classification planning on product actual uses, generating an index data checking computation list and the result of the classification planning of the product actual uses; S4. calculating project total cost estimation data of the land investment calculation plan; S5. arranging the investment planning data of the land investment calculation plan, and generating a corresponding plan table; S6. generating a land value-added tax table, a cash flowmeter table and a profit table; and S7. generating a project index presentation table, and completing the calculation. According to the invention, a computer software is used to realize index data checking, project total cost calculation and investment planning of the real estate project product planning, presents the result of the calculation through the project index presentation table, and has high accuracy of investment calculation. The computer software realizes automatic analysis of data and has high working efficiency.

Owner:深圳市爱德数智科技股份有限公司

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com