Patents

Literature

80 results about "Currency amount" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

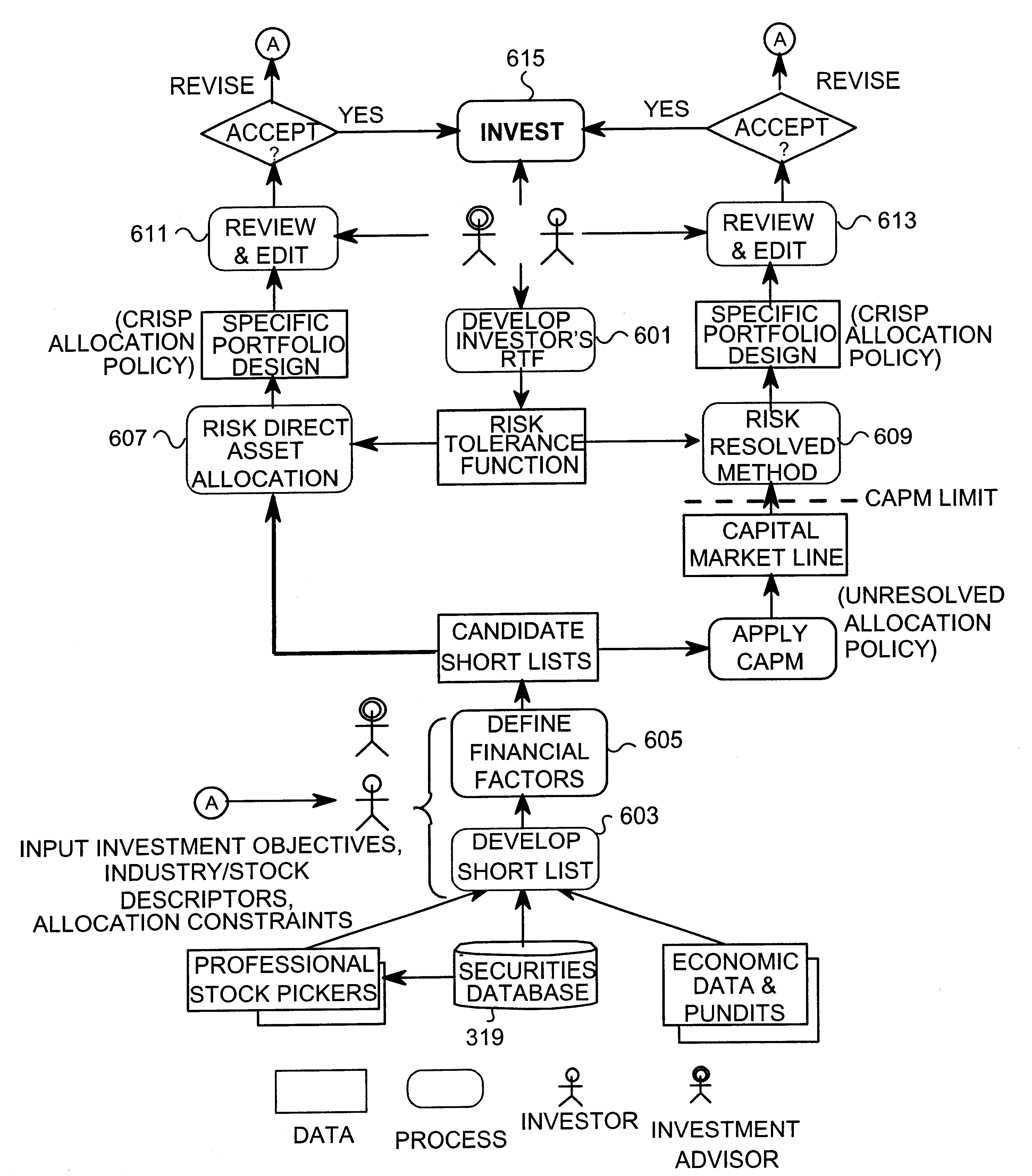

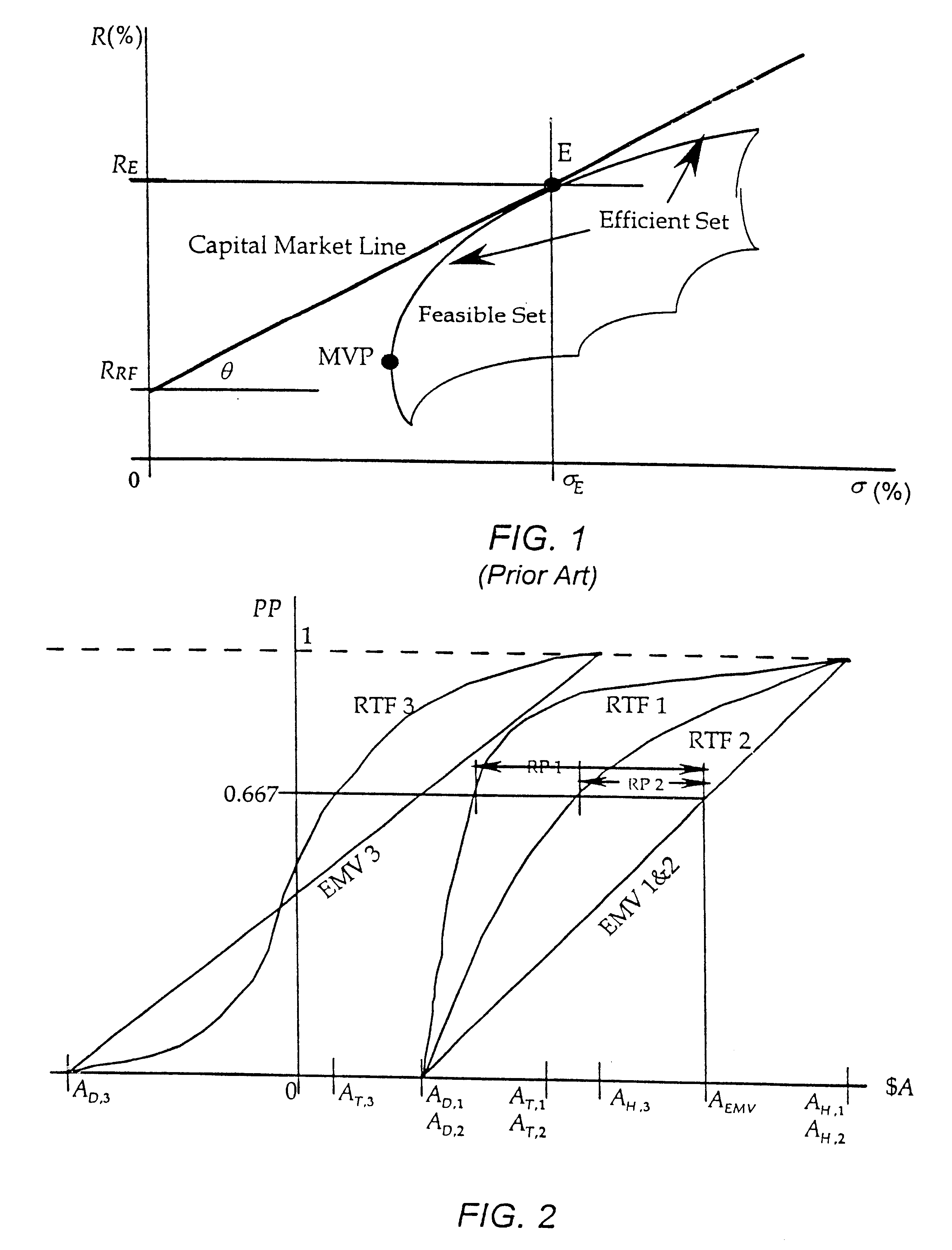

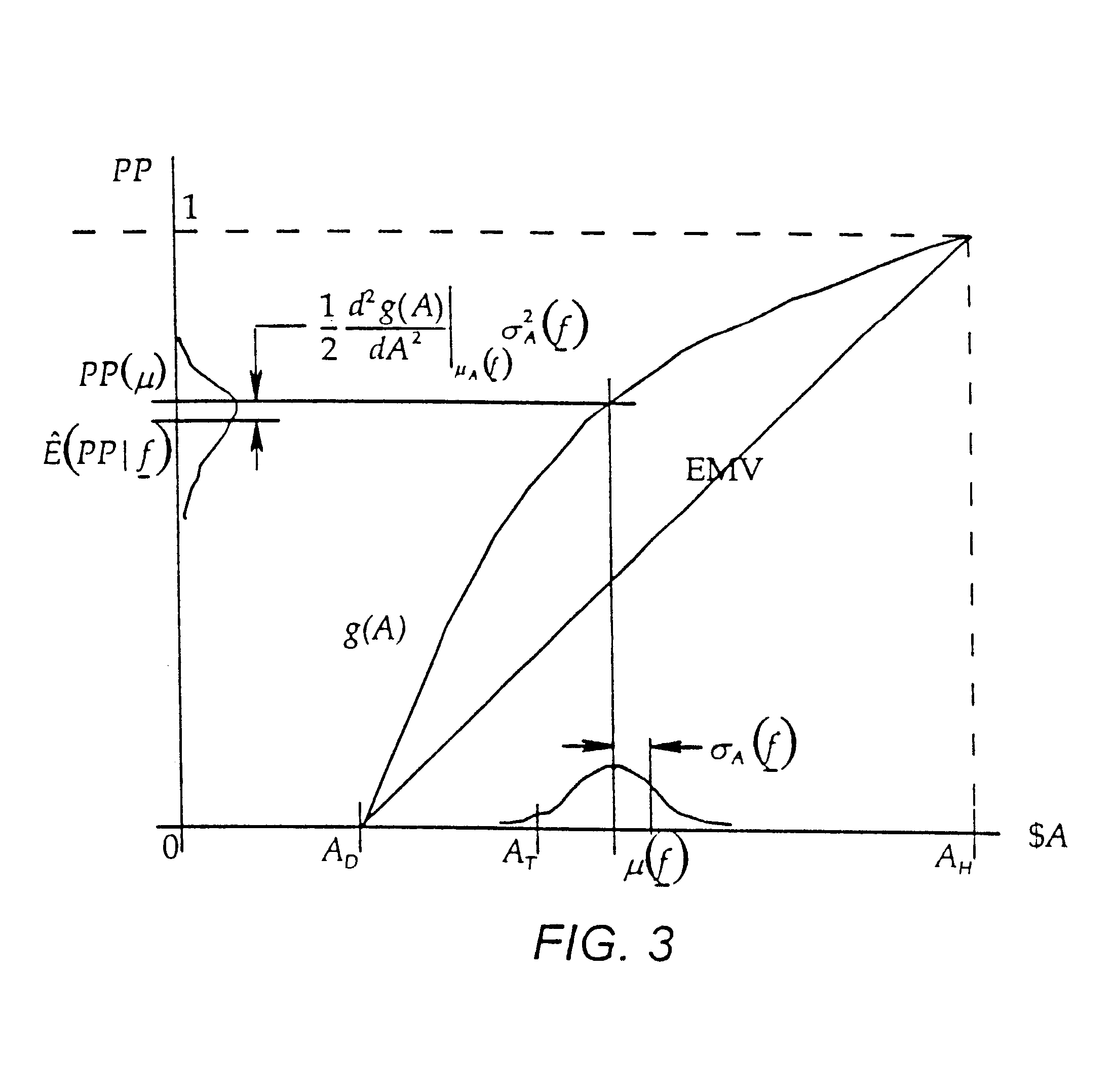

System and method for data collection, evaluation, information generation, and presentation

InactiveUS6405179B1Easy to optimizeFinanceSpecial data processing applicationsComputer sciencePareto optimal

A system and method for the optimal allocation of investment funds among a portfolio of investments, and the optimal selection of candidate investments for the portfolio to optimize the financial risk of the investor relative to the financial returns. The system and method create risk tolerance functions for the investor which describe the investor's monetary utility through probability preferences with respect to specific currency amounts relative to the investor's overall assets restricted to the investors monetary range of interest. The risk tolerance function is then used in conjunction with a computed probability density function of the investment portfolio to create a probability density function of the investor's probability preferences with respect to the investor's risk tolerance function. The probability density function expresses the dispersion of risk preferences that the investor would experience as a result of the investment allocation. Investment funds are allocated to the investments of the portfolio by maximizing the expected value of the probability density function of the investor's probability preferences within a rich environment of possible parameters

Owner:RELENTLESS INTPROP LLC +1

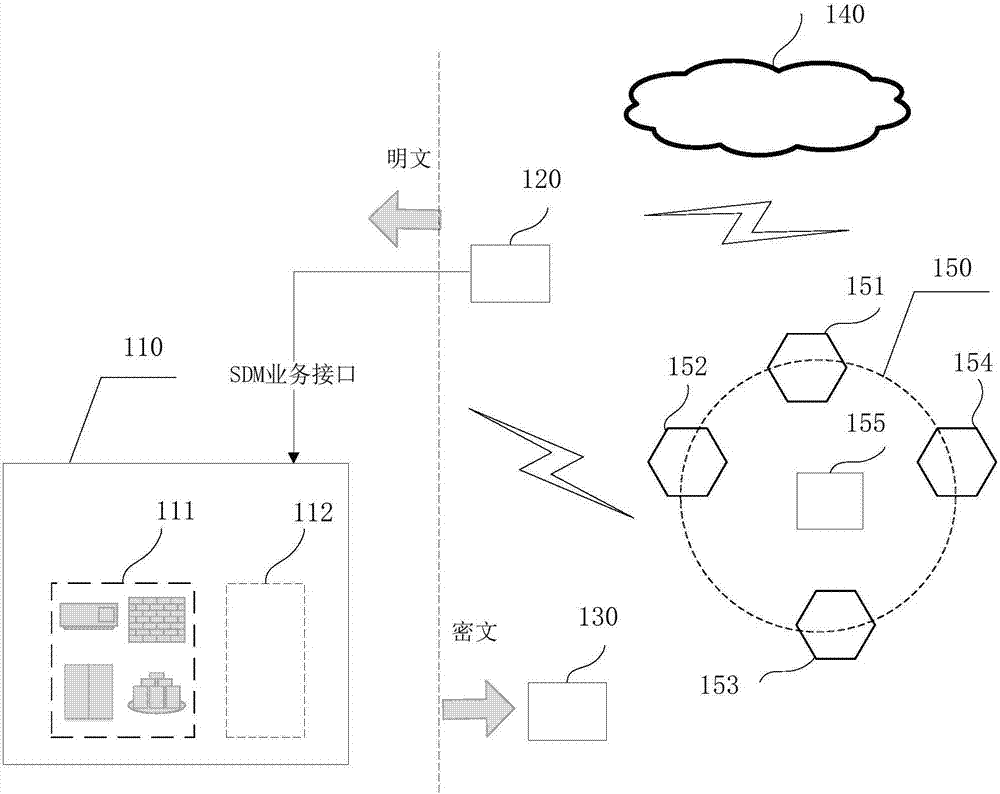

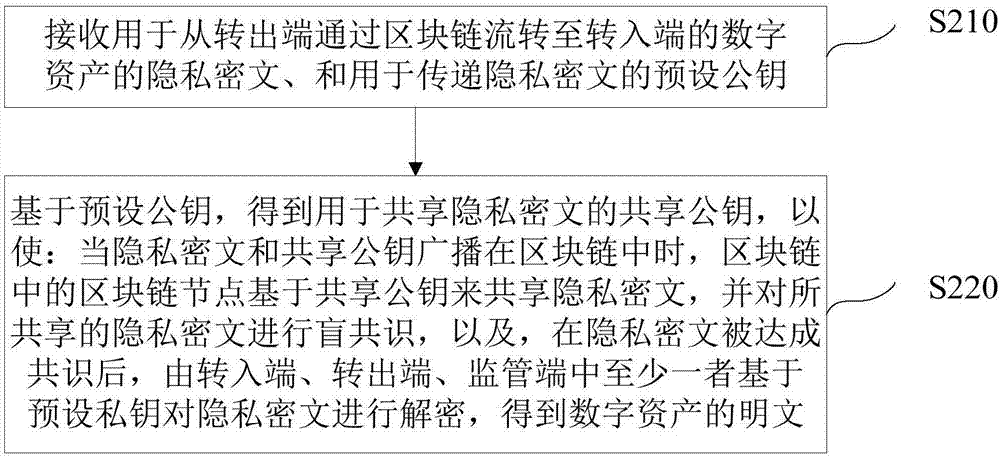

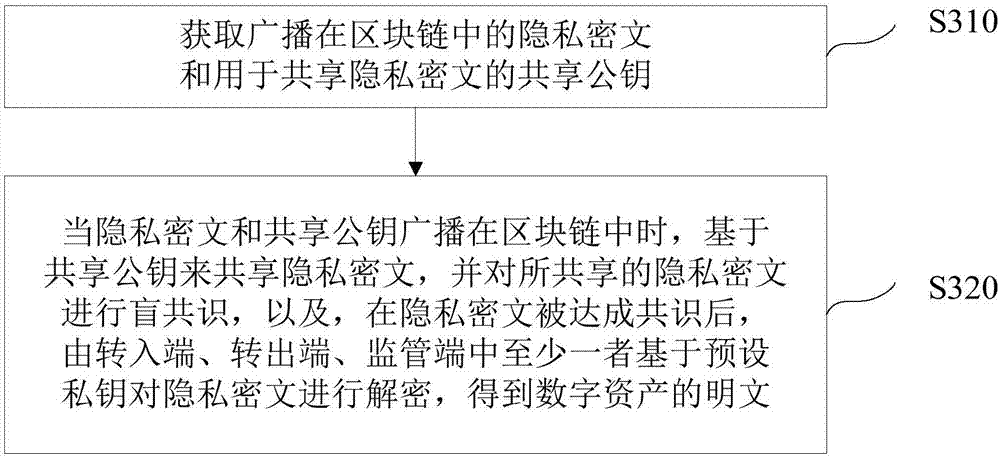

Blockchain-based digital asset processing method and device

ActiveCN106982205AProtection of privacySmooth circulationKey distribution for secure communicationDigital data protectionPlaintextCiphertext

The invention discloses a blockchain-based digital asset processing method and device. The method comprises the following steps: receiving private ciphertext for a digital asset circulated from a sending end to a receiving end through a blockchain, and a preset public key; and obtaining a sharing public key for sharing the private ciphertext based on the preset public key, so that when the private ciphertext and the sharing public key are broadcast in the blockchain, blockchain nodes on the blockchain can share the private ciphertext based on the sharing public key and reach a blind consensus on the shared private ciphertext, and after the consensus on the private ciphertext is reached, the private ciphertext can be decrypted by at least one of three parties, i.e., the sending end, the receiving end and a monitoring end, based on a preset private key to obtain plaintext of the digital asset. The method and device provided by the embodiment of the invention has the advantages that the privacy right of a user is protected; under the premise of privacy protection, the single general digital asset can be smoothly circulated within one blockchain or among multiple blockchains, and a total currency amount remains unchanged; and a monitoring party other than the transaction parties can monitor transaction information at any time.

Owner:中钞信用卡产业发展有限公司杭州区块链技术研究院 +1

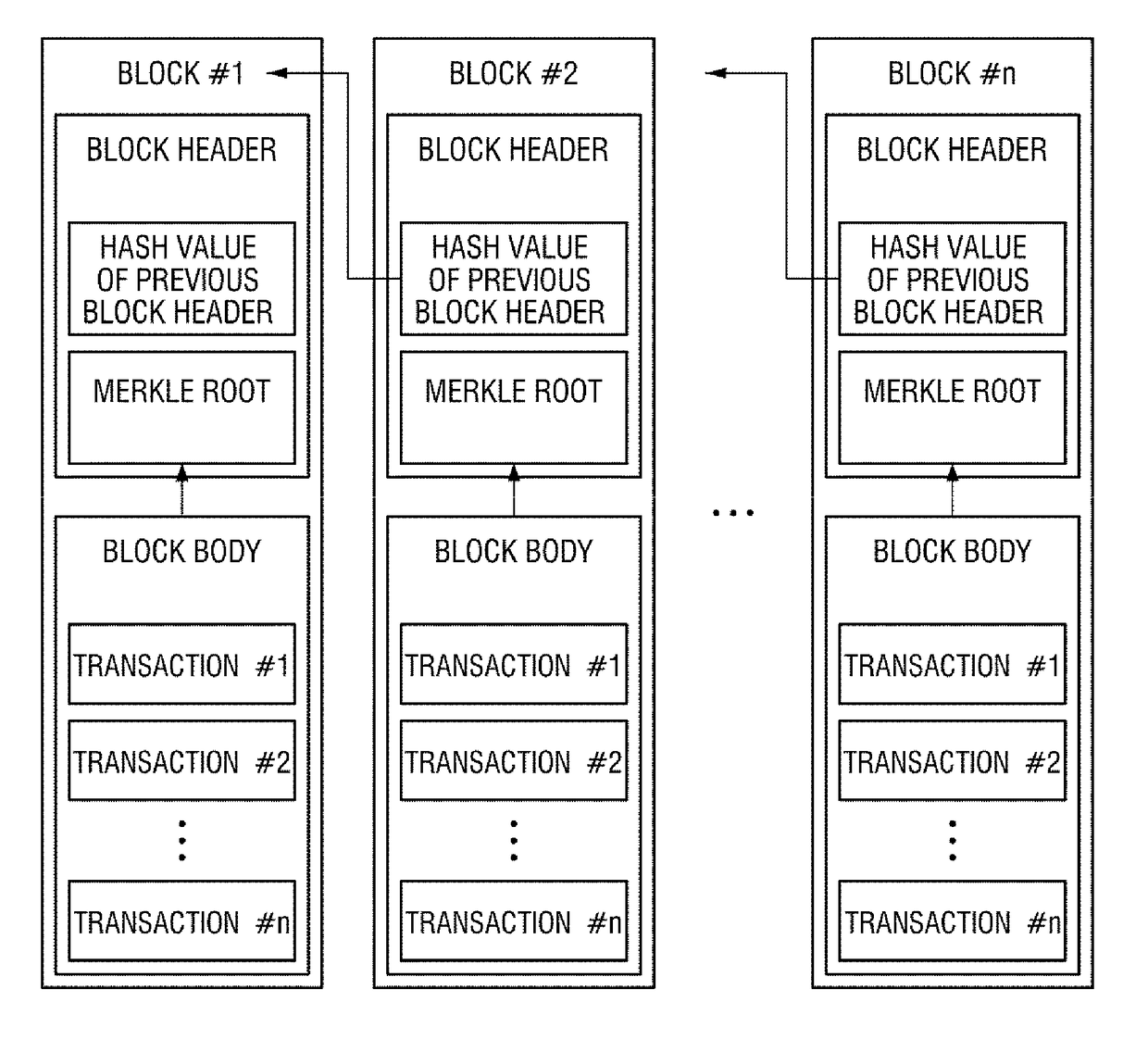

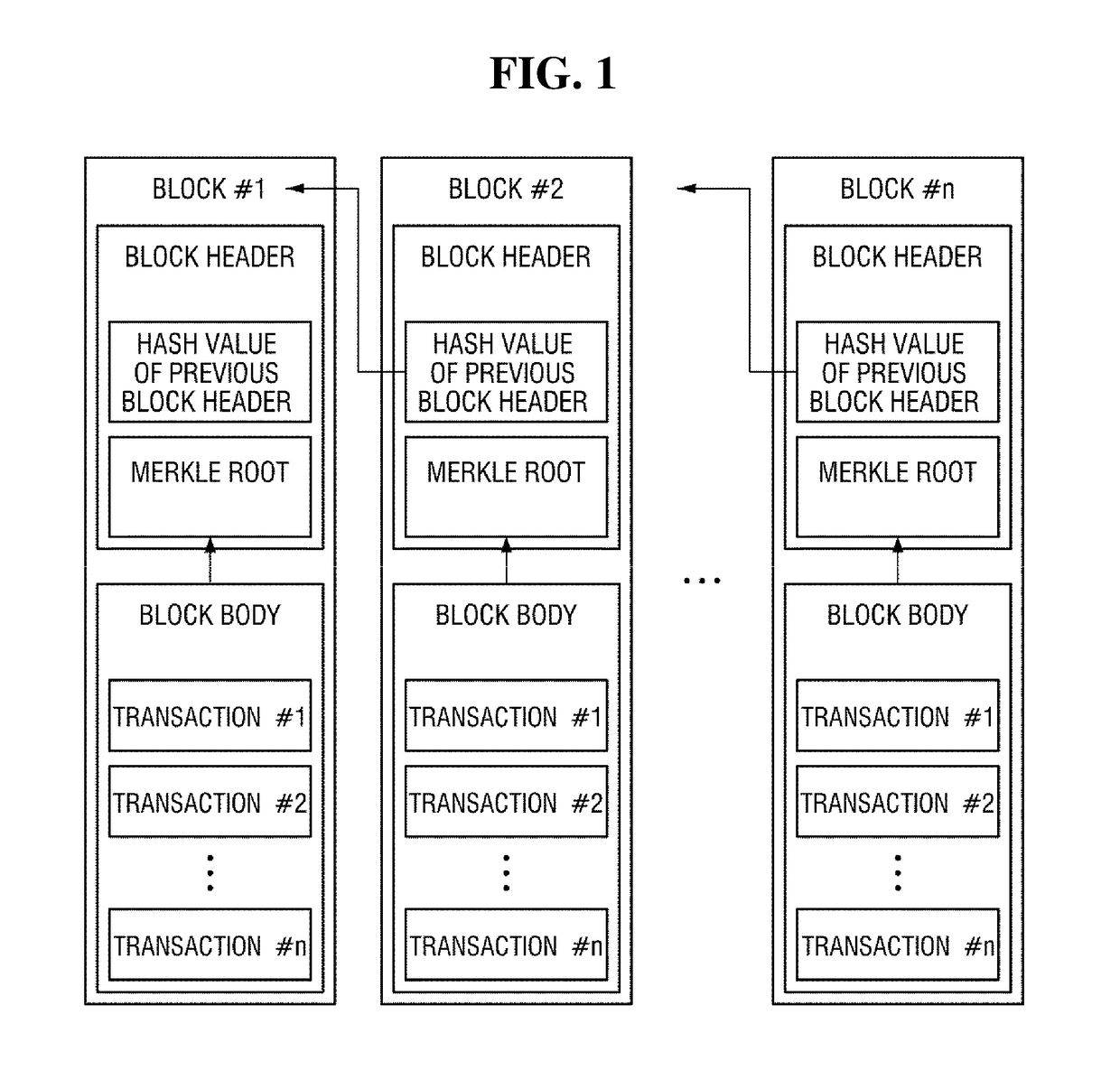

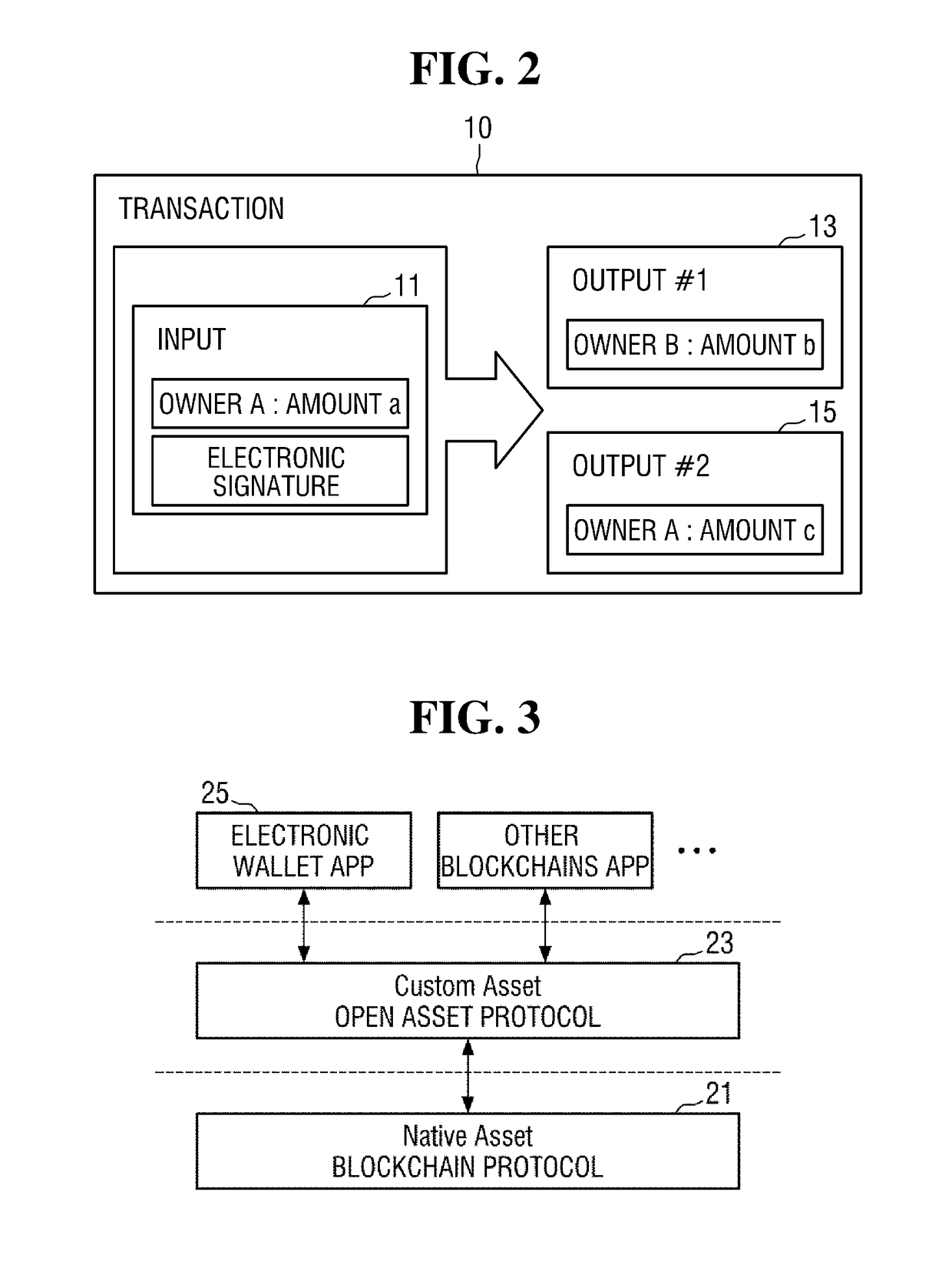

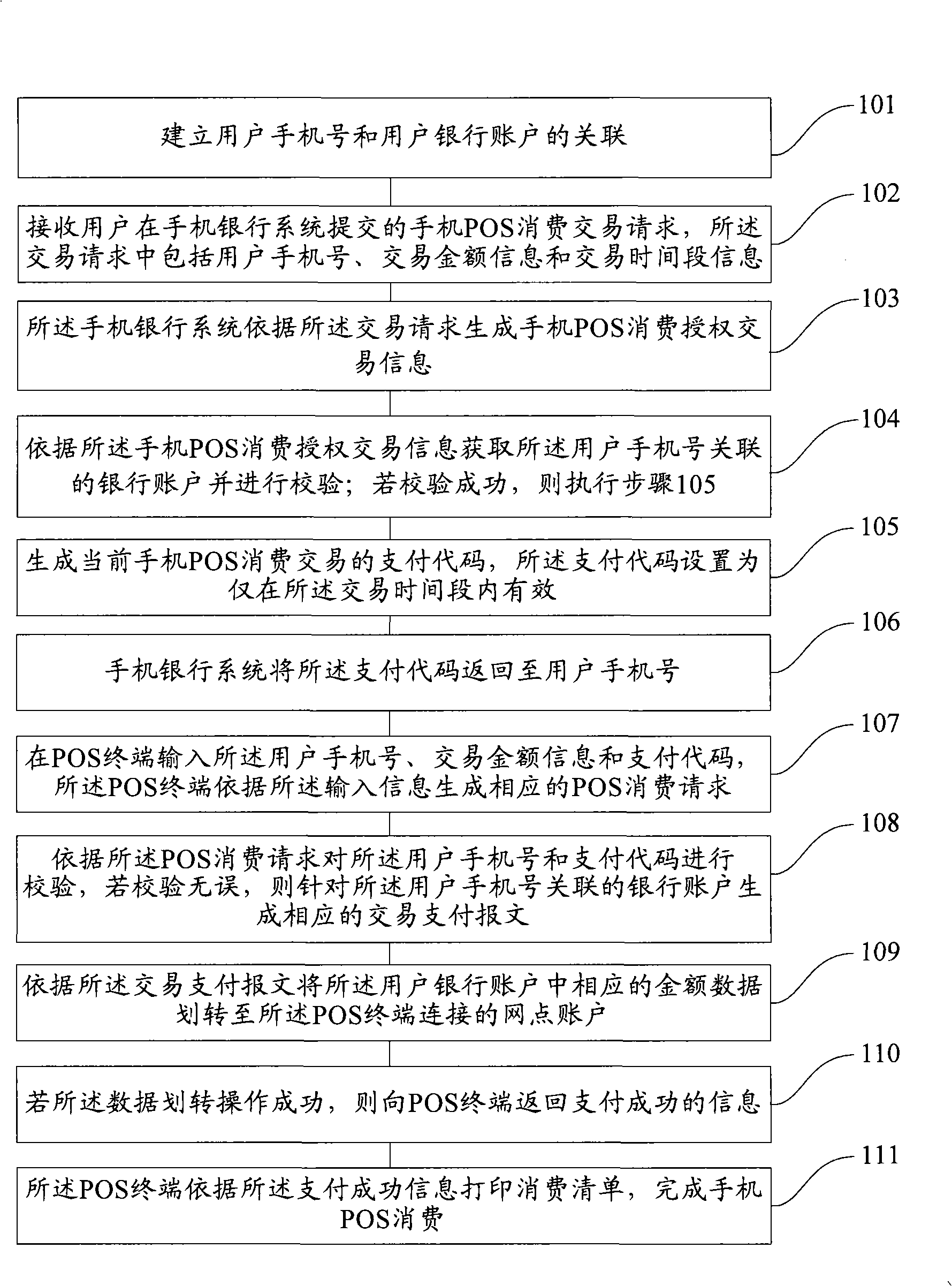

System for custom currency transaction based on blockchain and operating method thereof

PendingUS20180293576A1Encryption apparatus with shift registers/memoriesCurrency conversionTransaction serviceService provision

Provided are a blockchain-based custom currency transaction system comprising a plurality of blockchain nodes configured to establish a peer-to-peer (P2P)-based blockchain network, distribute and manage blockchain data in which a plurality of blocks are connected in a chain form, and record, using the blockchain data, transaction data of a custom currency defined based on a cryptocurrency and a service providing server configured to interwork with the blockchain network and provide a transaction service for the custom currency, wherein the transaction data comprises first information about a first currency amount of the custom currency to be transacted and second information about a second currency amount of the cryptocurrency to be transacted.

Owner:SAMSUNG SDS CO LTD

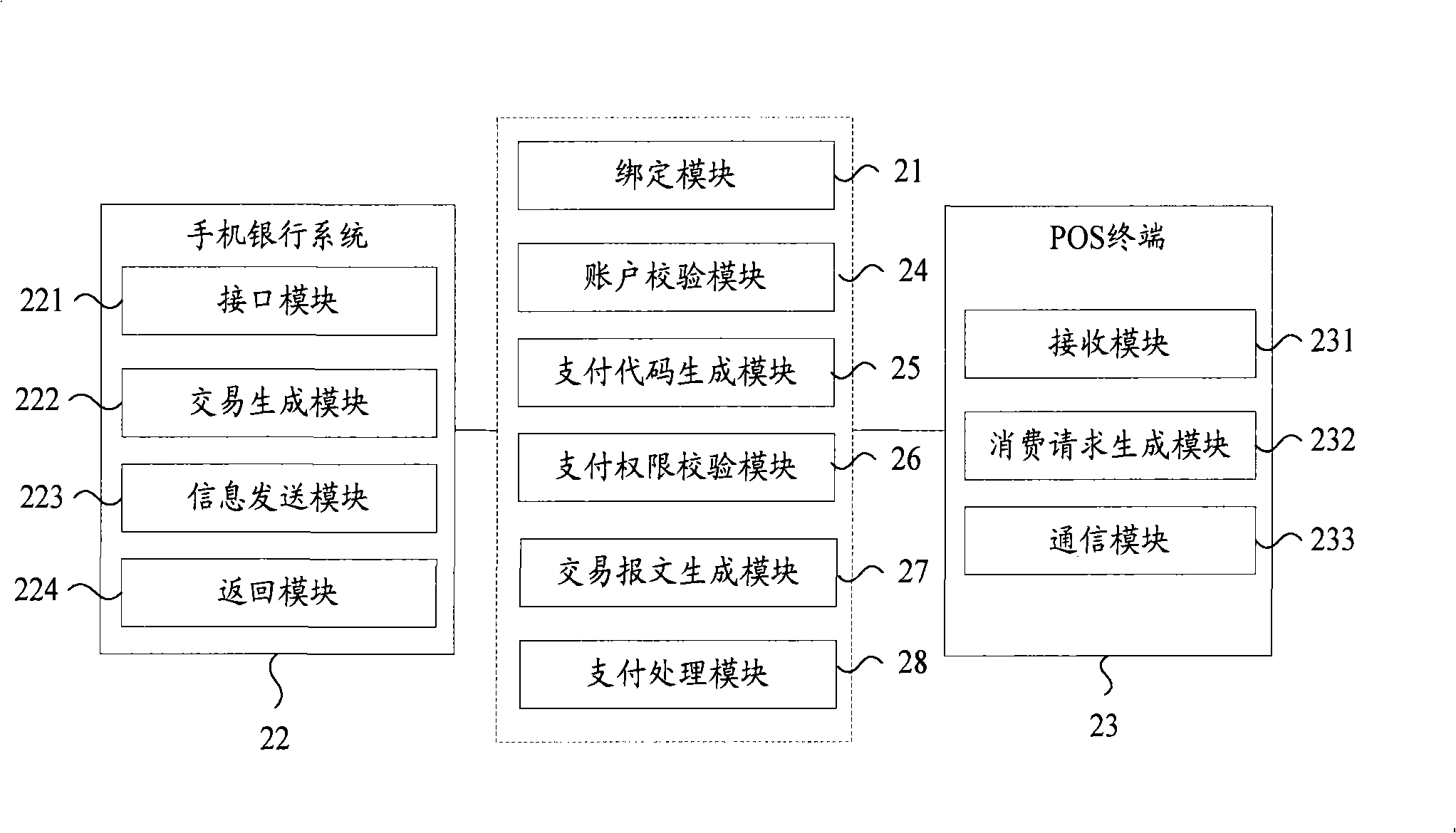

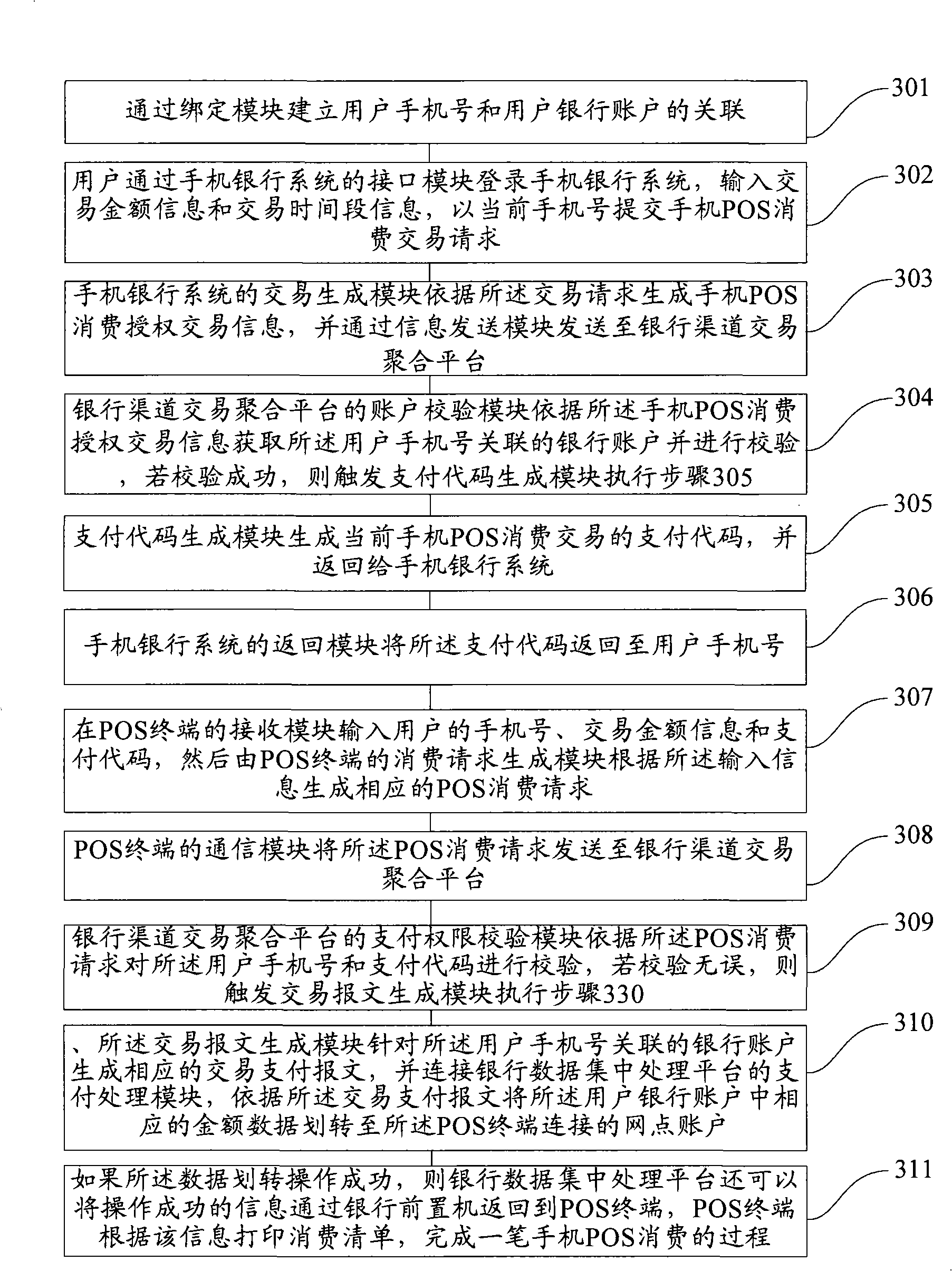

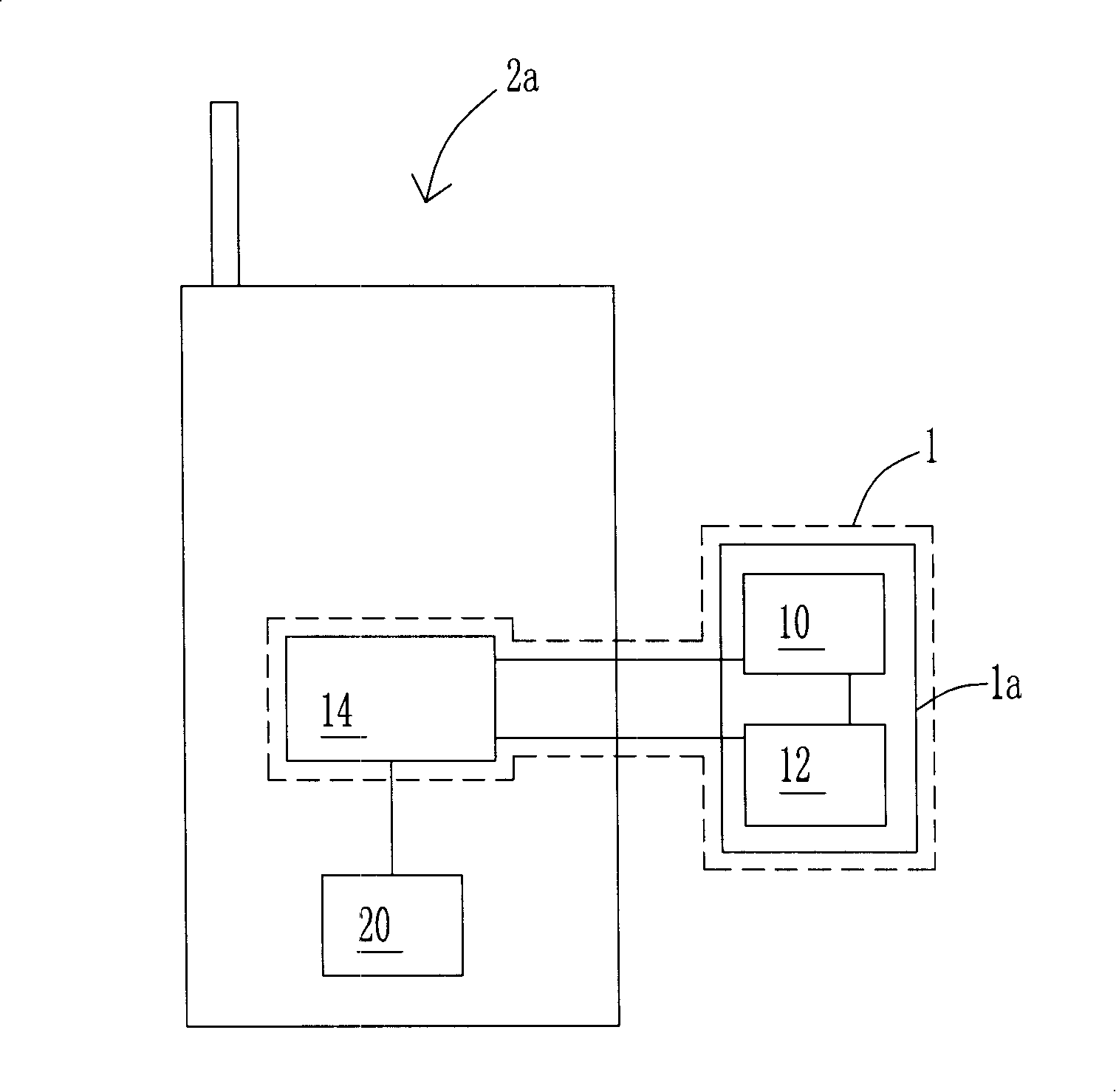

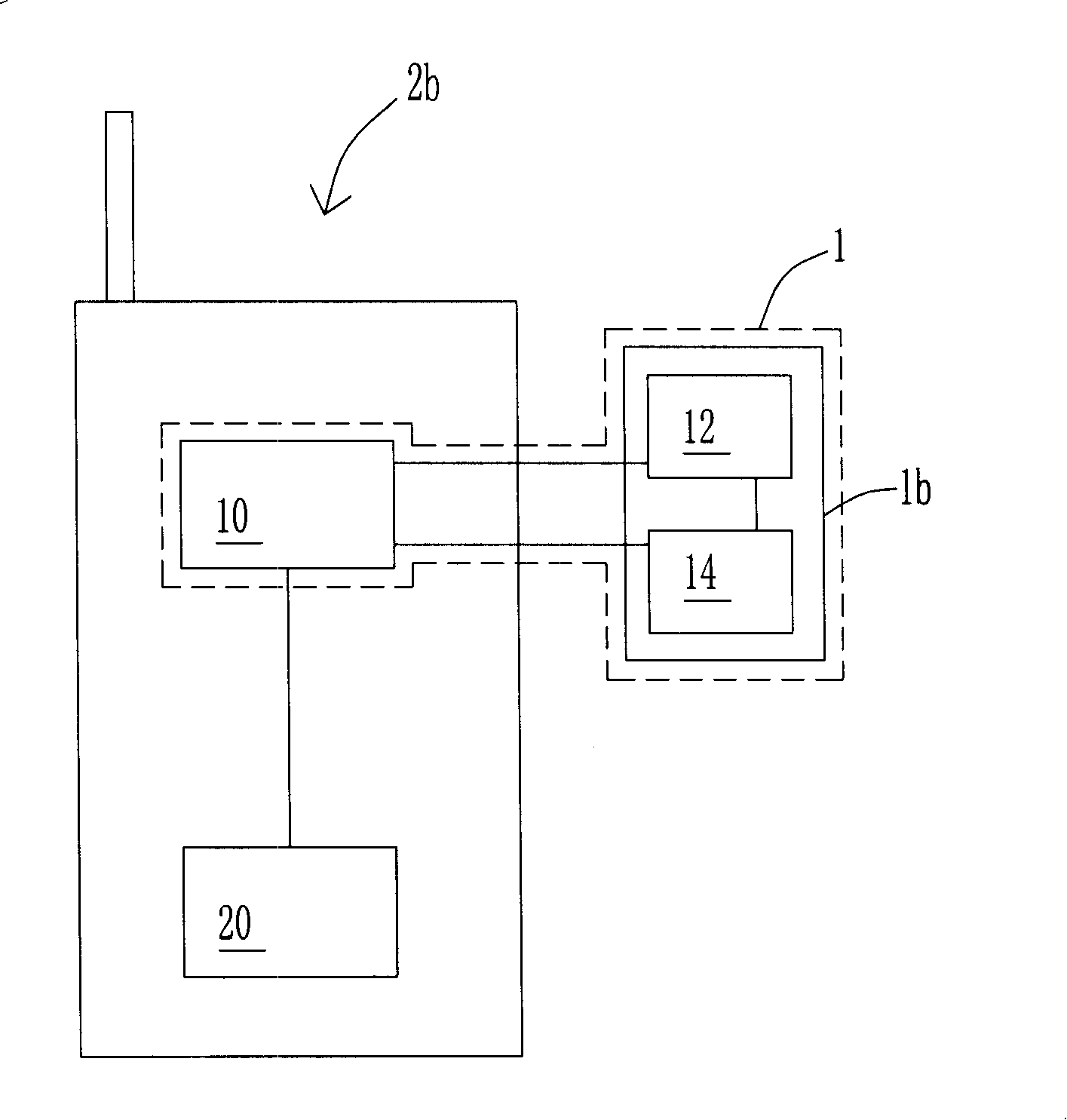

Method for processing mobile phones POS consumptive data and mobile phones POS consumption system

ActiveCN101329801AWays to increase cashless paymentsSolve the problem of not being able to combineComplete banking machinesCash registersBank accountComputer terminal

The invention discloses a data processing method for mobile phone POS consumption, which comprises that connection between the mobile phone number and the bank account of a user is established; a mobile phone POS consumption transaction request submitted by the user in the mobile phone banking system is received; the mobile phone banking system generates the mobile phone POS consumption authorization transaction information according to the transaction request; the bank account relevant to the mobile phone number of the user is acquired and verified; if the verification passes, a payment code of the current mobile phone POS consumption transaction is generated and returned to the mobile phone number of the user; the mobile phone number, the transaction amount information and the payment code of the user are input to the POS terminal to generate the corresponding POS consumption request; then the mobile phone number of the user and the payment code are verified and if the mobile phone number and the payment code are proved to be right after verification, a corresponding transaction payment report relevant to the corresponding bank account is generated; the corresponding currency amount is transferred from the bank account of the user to the network account connected to the POS terminal according to the transaction payment report. The data processing method has low cost and improves the security of the POS consumption.

Owner:CHINA CONSTRUCTION BANK

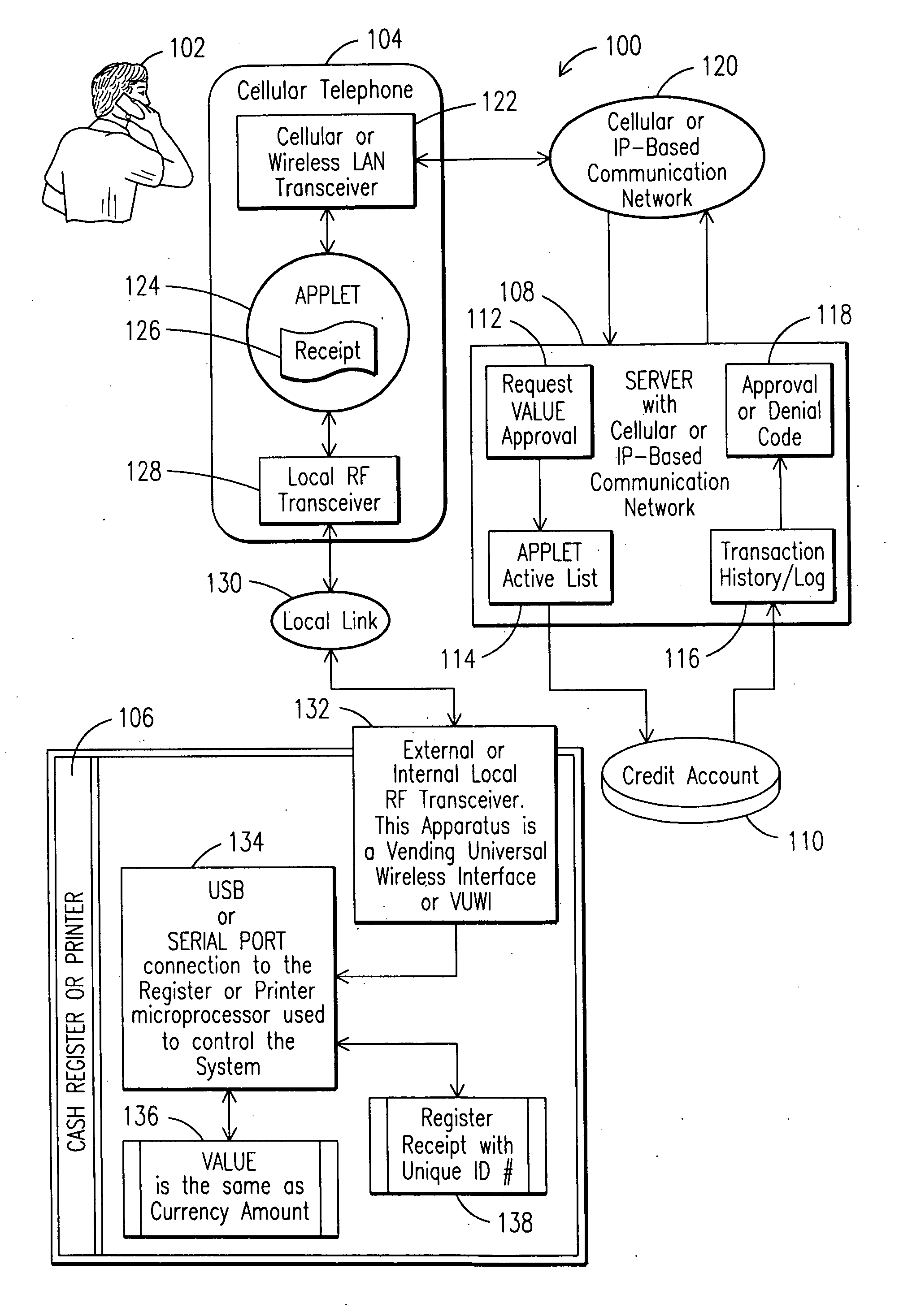

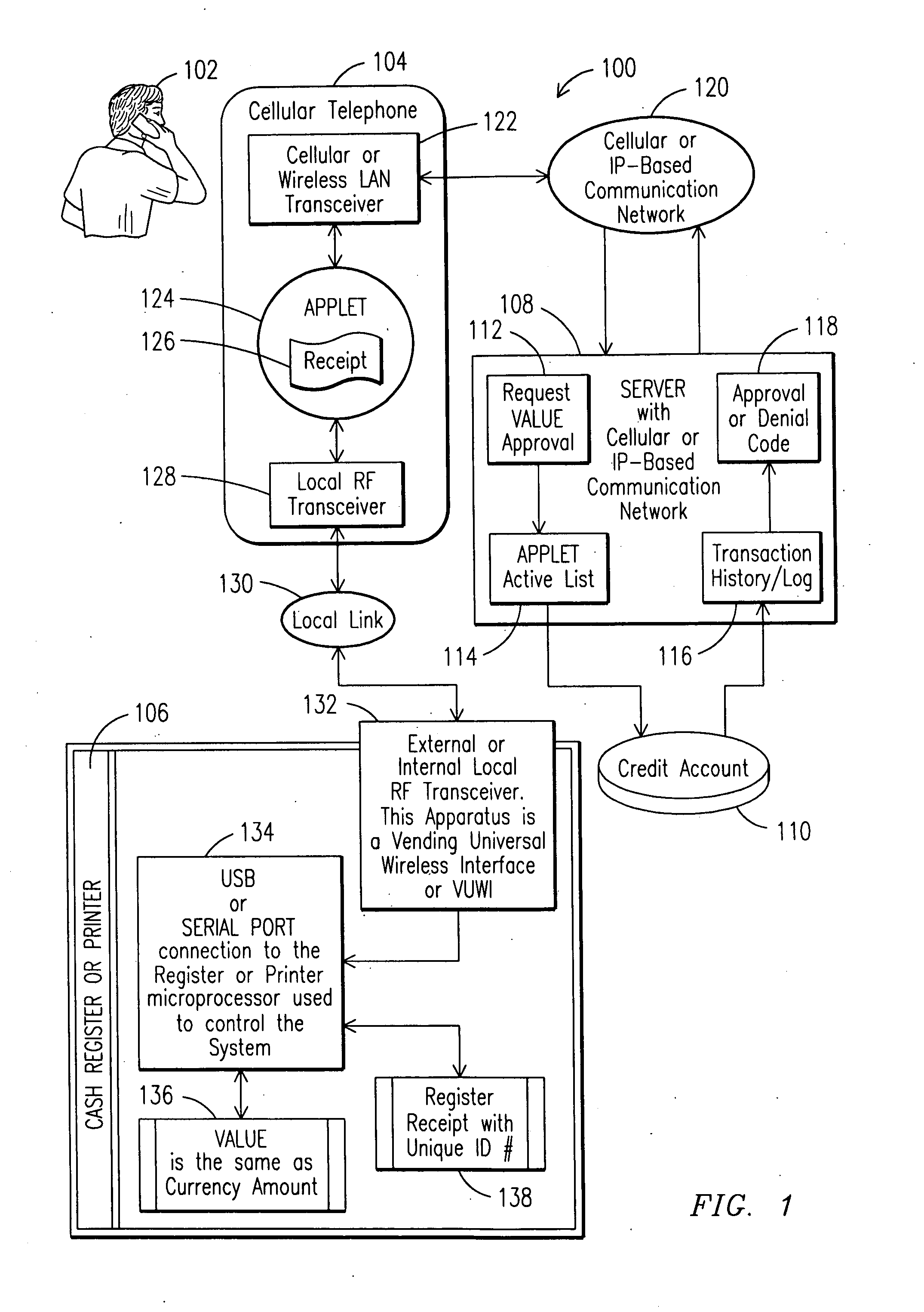

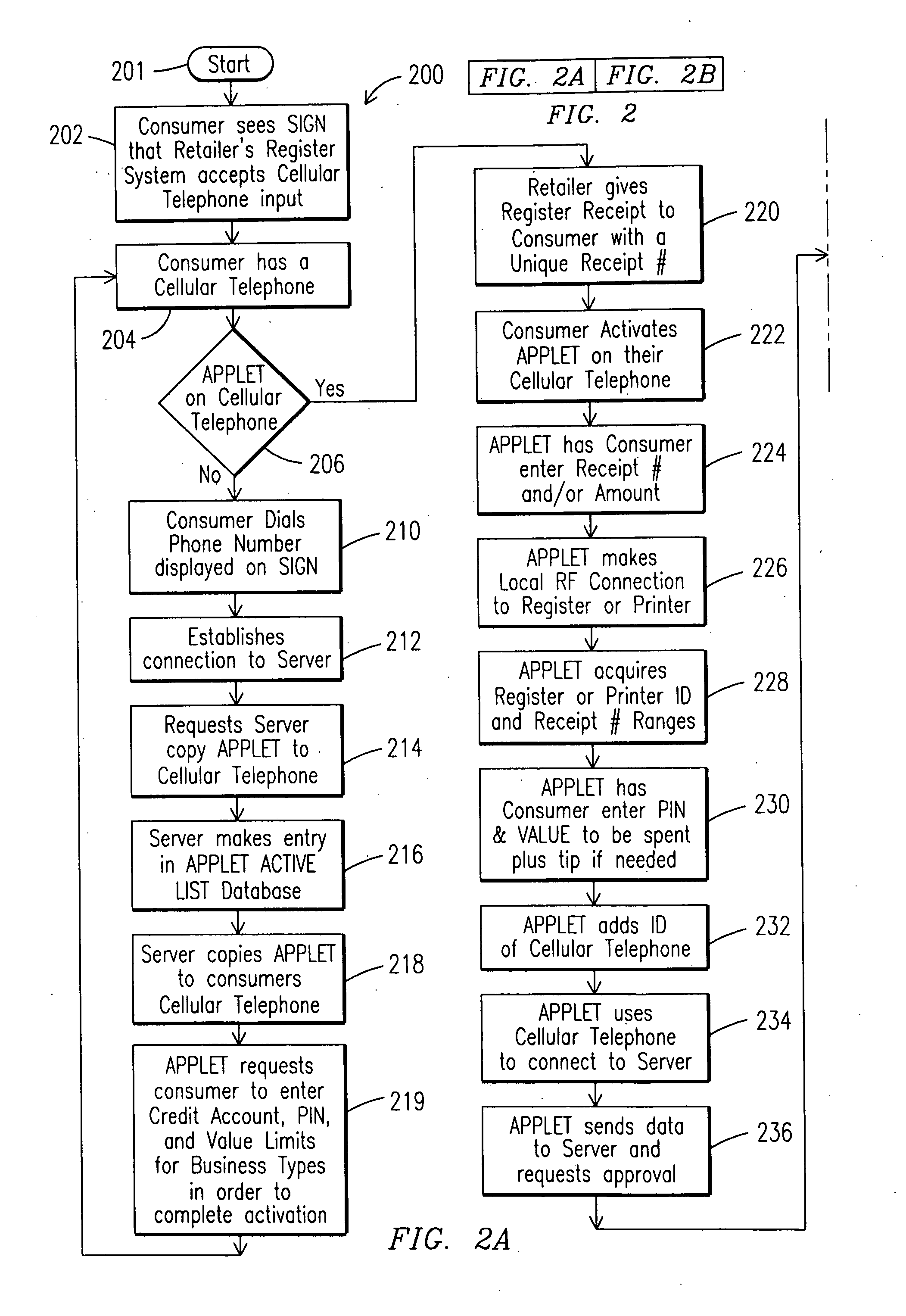

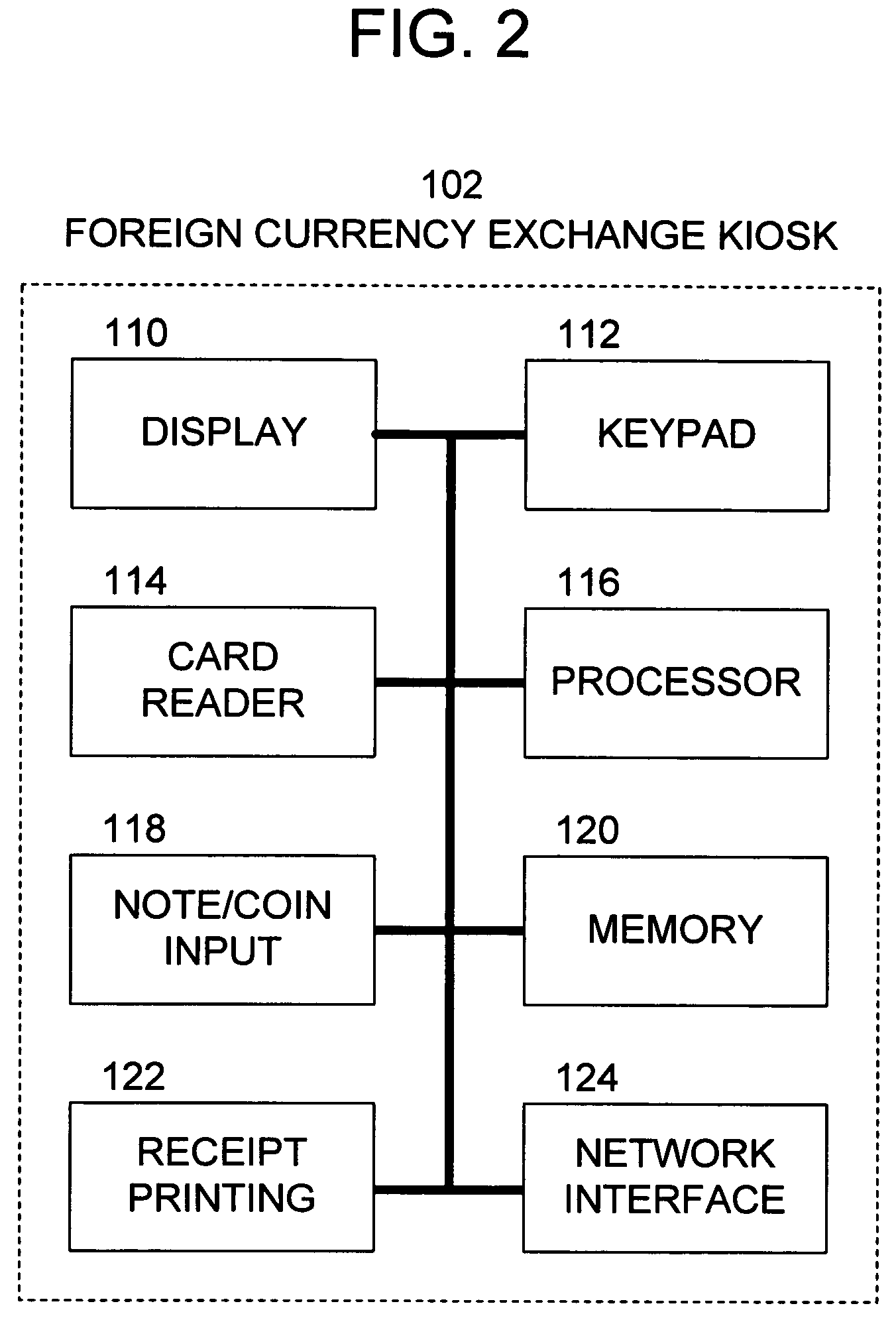

Apparatus and method of establishing credit on a cash register or printer

InactiveUS20110153442A1Hand manipulated computer devicesAccounting/billing servicesPaymentMicroprocessor controller

A method and system is provided for establishing credit on a cash register or printer. A currency amount is established on a cash register or printer in order to pay for a product or service using a cellular telephone, or other personal wireless communication device. The personal wireless communication device activates an applet, which may be downloaded at the site, to establish a link with a vending universal wireless interface (VUWI) coupled to the cash register or printer's microprocessor controller to establish a link with a remote server for authorizing credit for the payment of the transaction to complete a purchase by a consumer.

Owner:KRAMPE RICHARD L

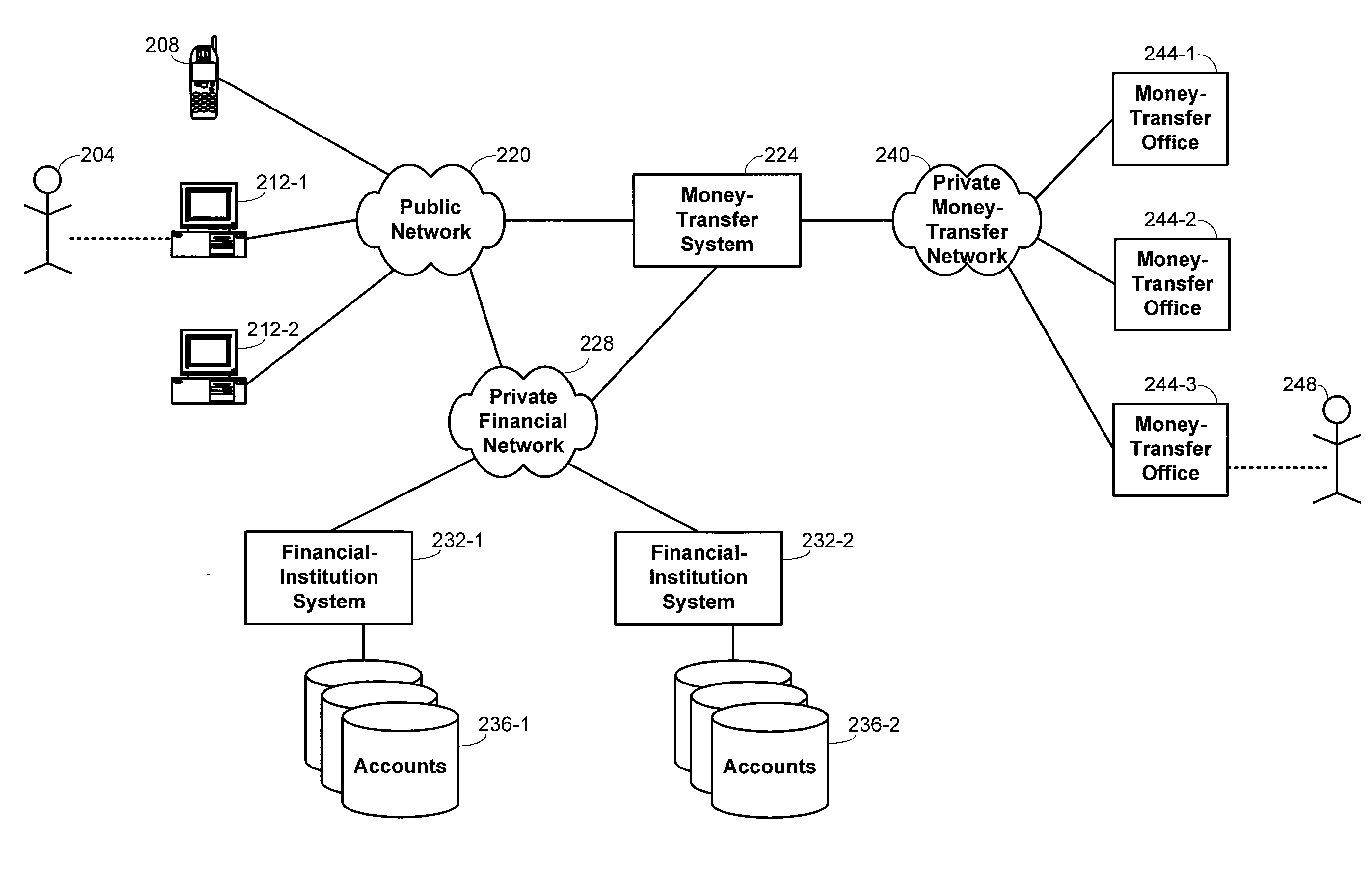

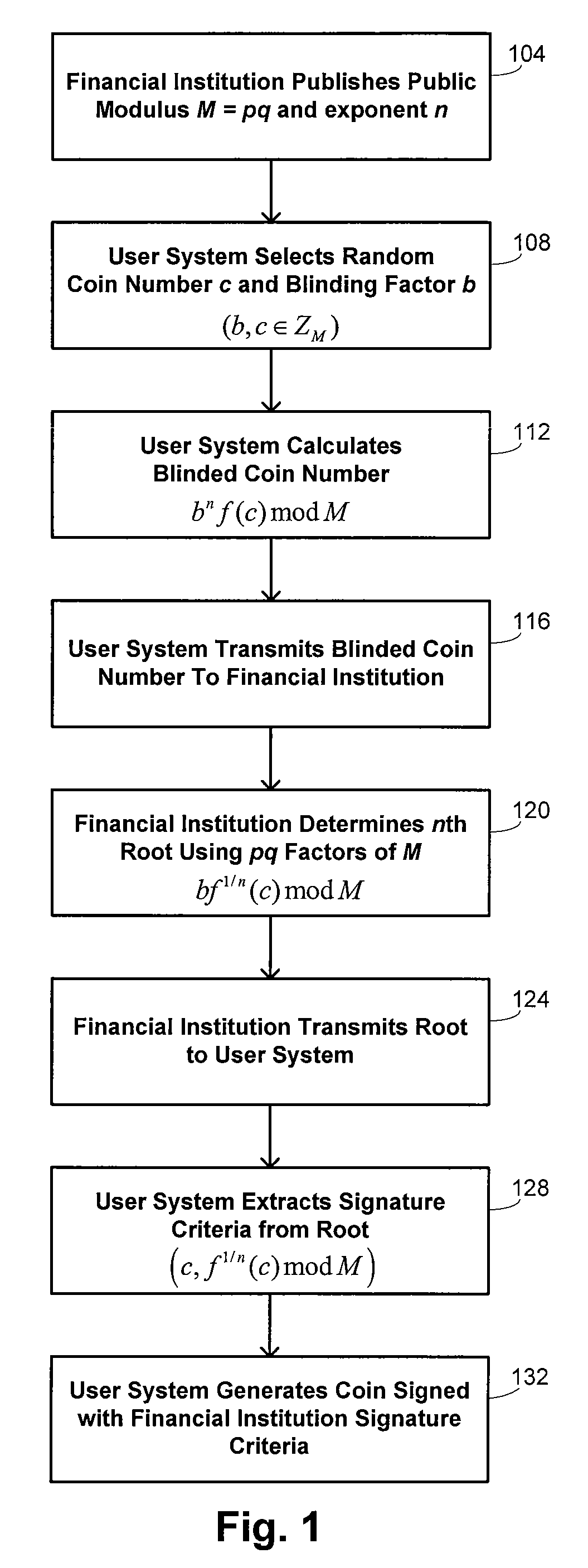

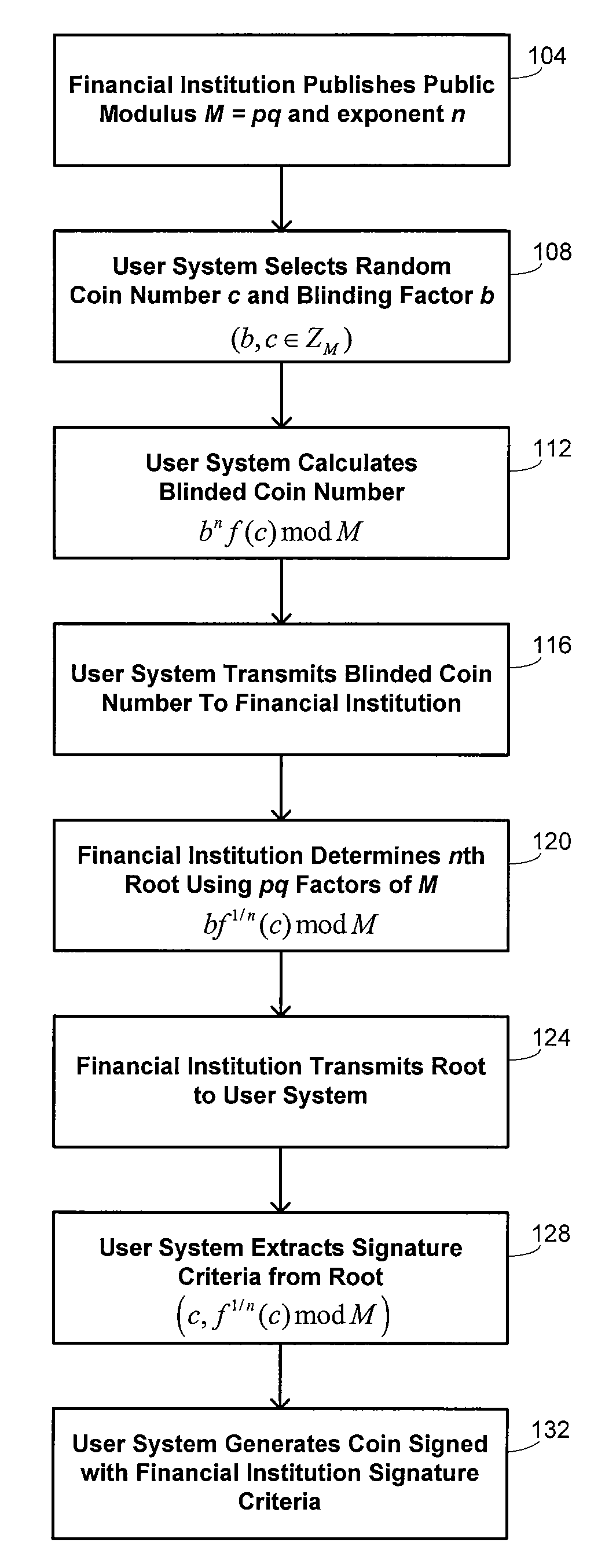

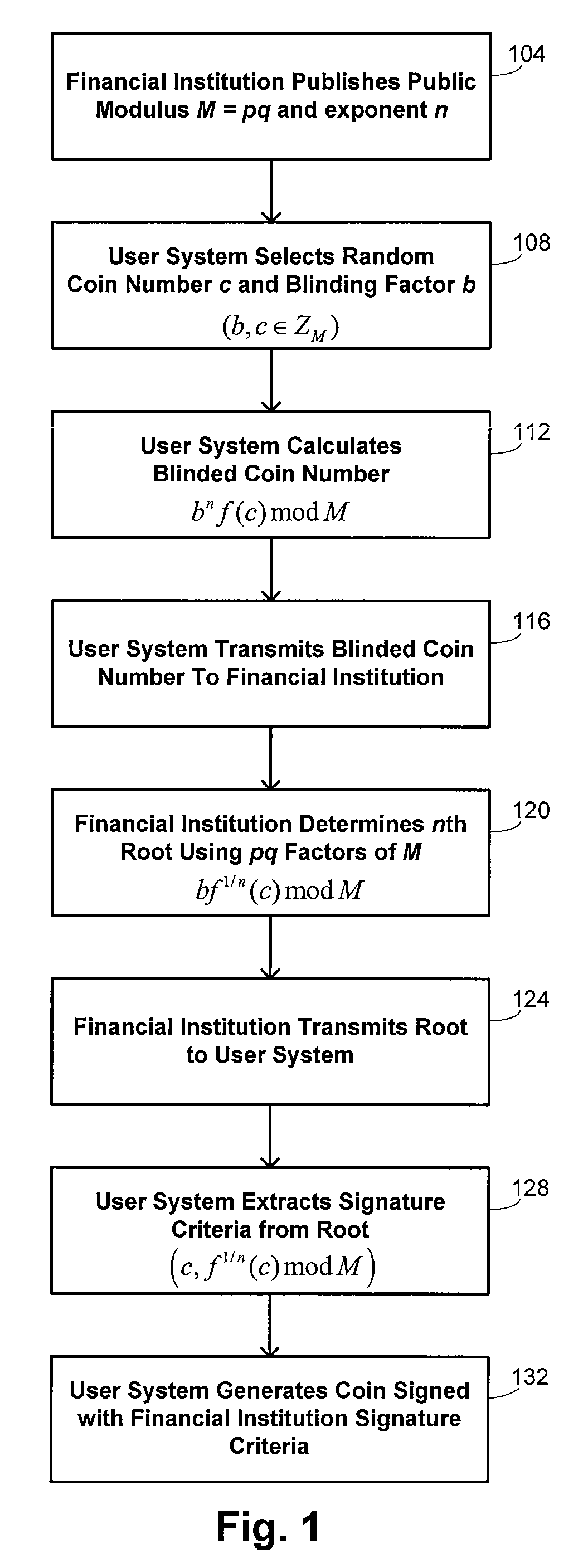

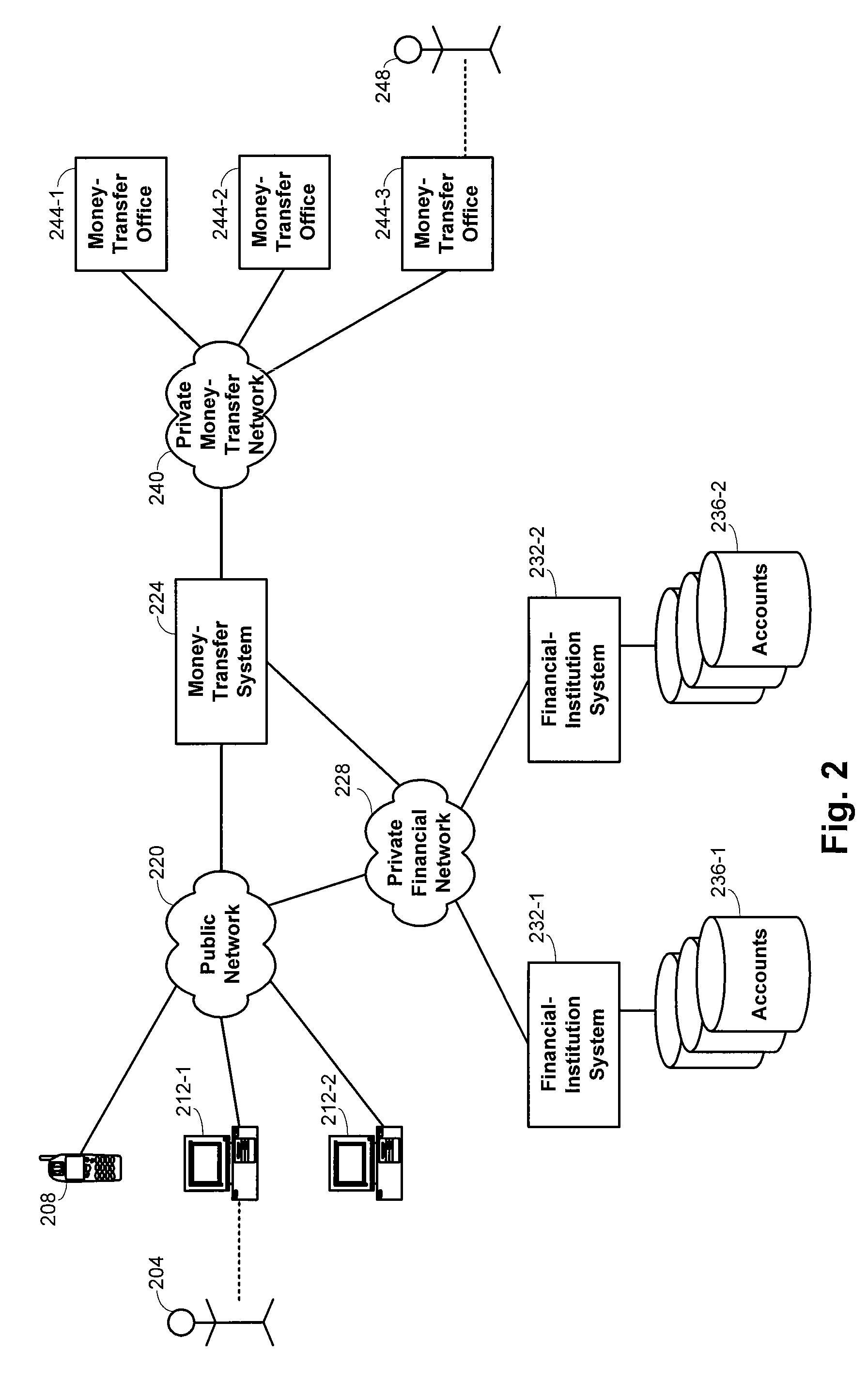

Money transfers using digital cash

Methods and systems are described for transferring funds from a sender to a recipient. Source funds are received from a sender. An amount of recipient funds is determined from a value of the source funds. A transfer identifier associated with the recipient funds is generated and provided to the sender. The transfer identifier is received from the recipient, prompting a transfer in control of the recipient funds to the recipient. At least one of the source funds and the recipient funds are in the form of one or more electronic tokens. Each such electronic token has a currency amount and a digital signature identifying a financial institution that backs the electronic token for the currency amount.

Owner:FIRST DATA

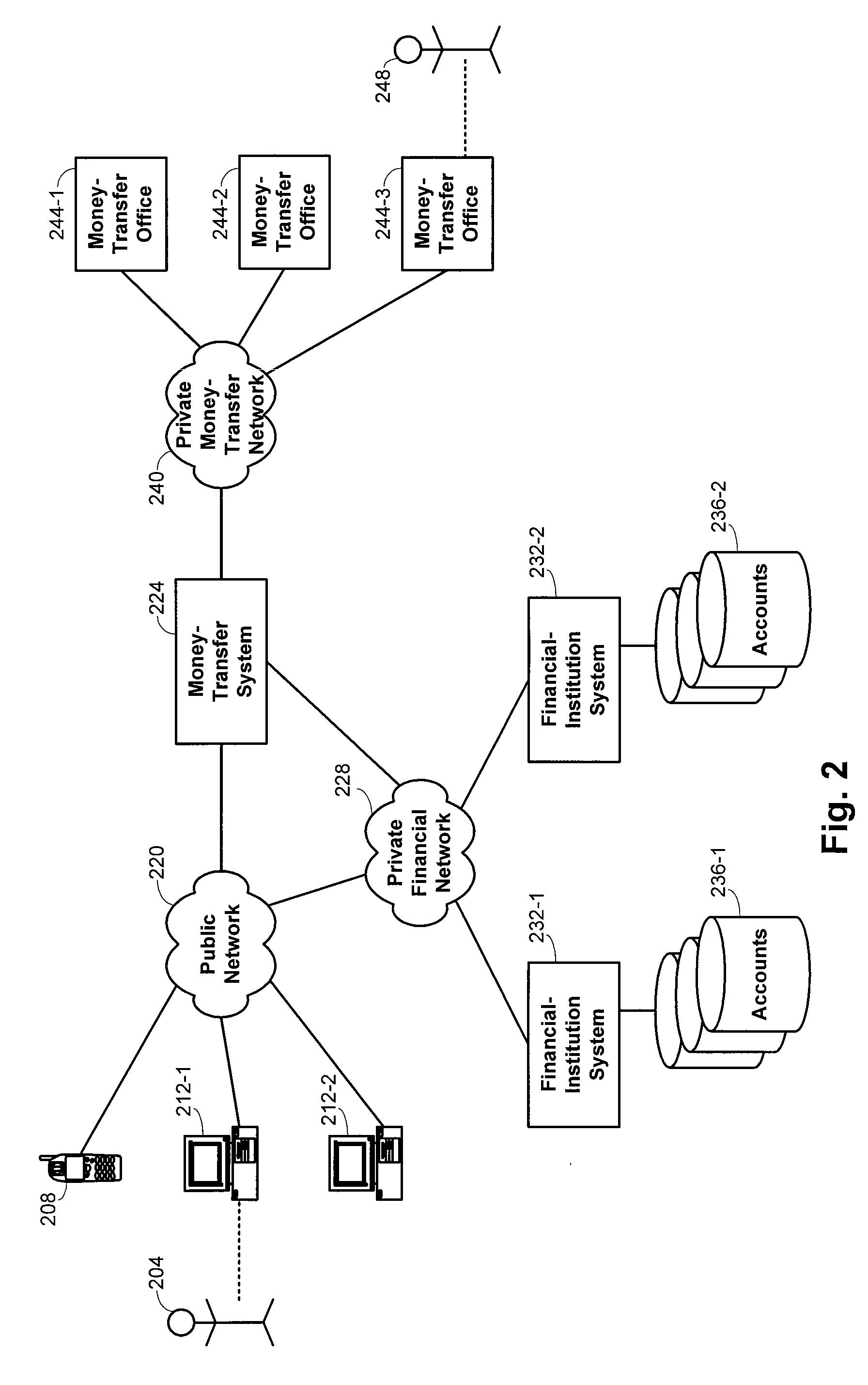

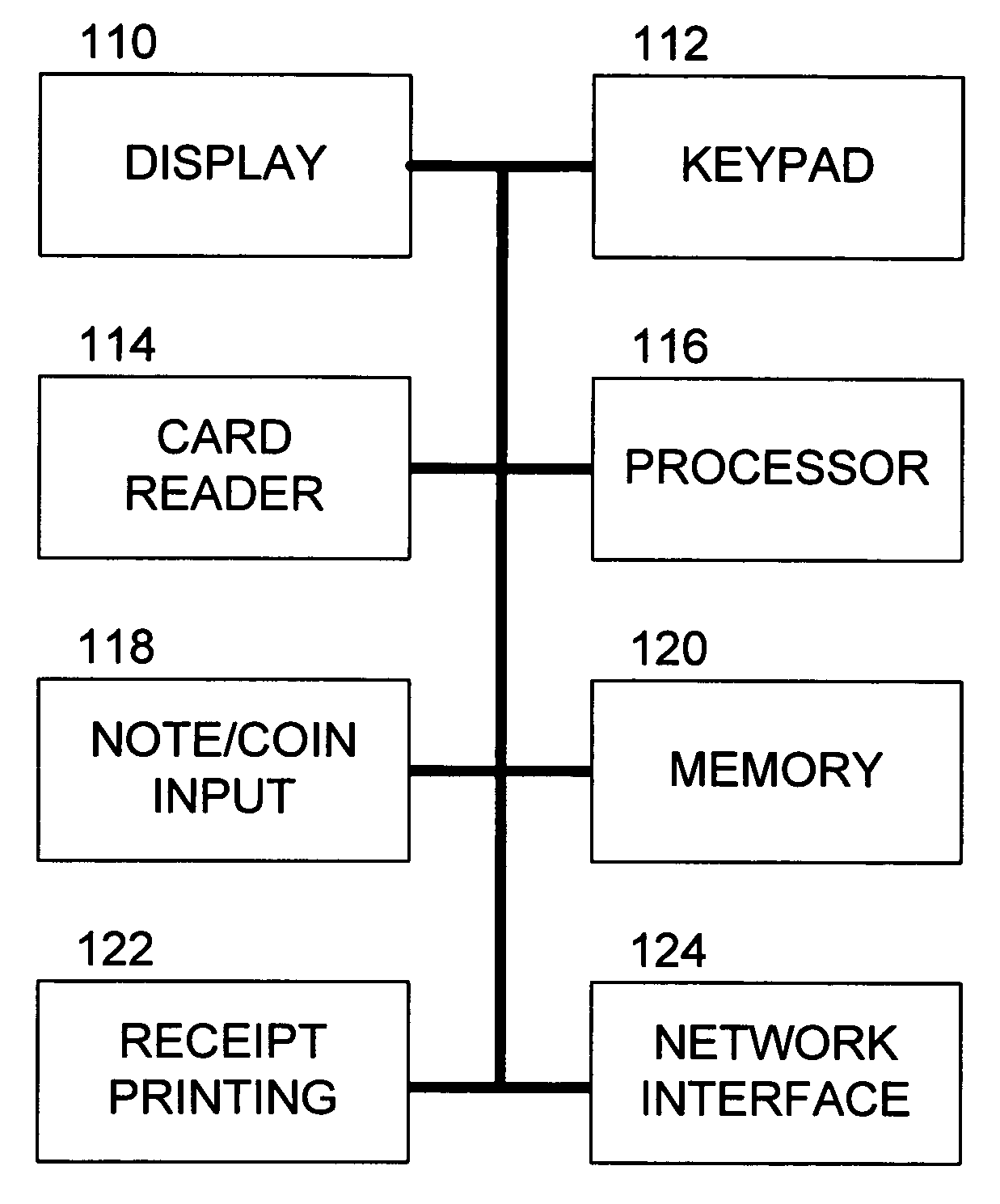

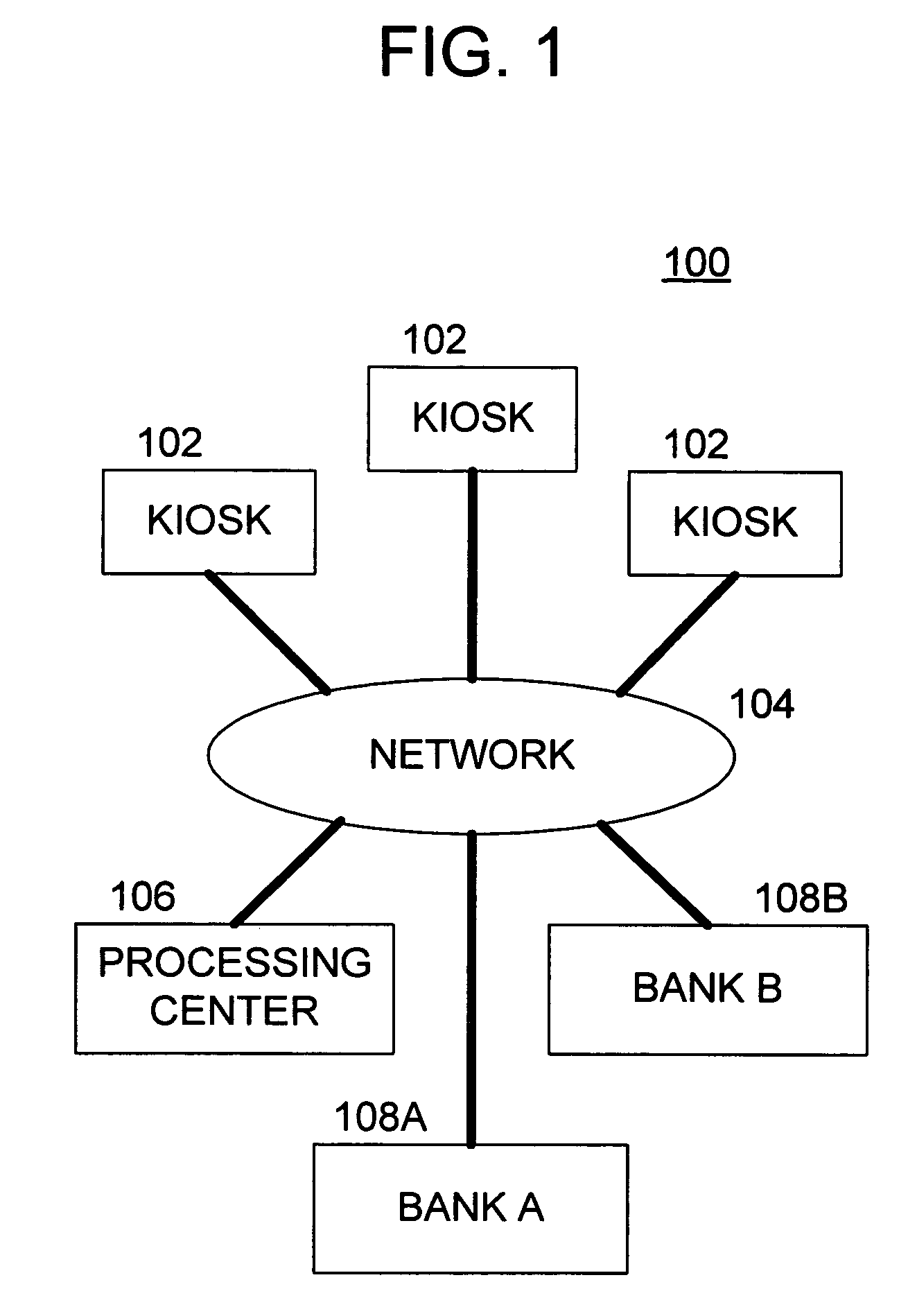

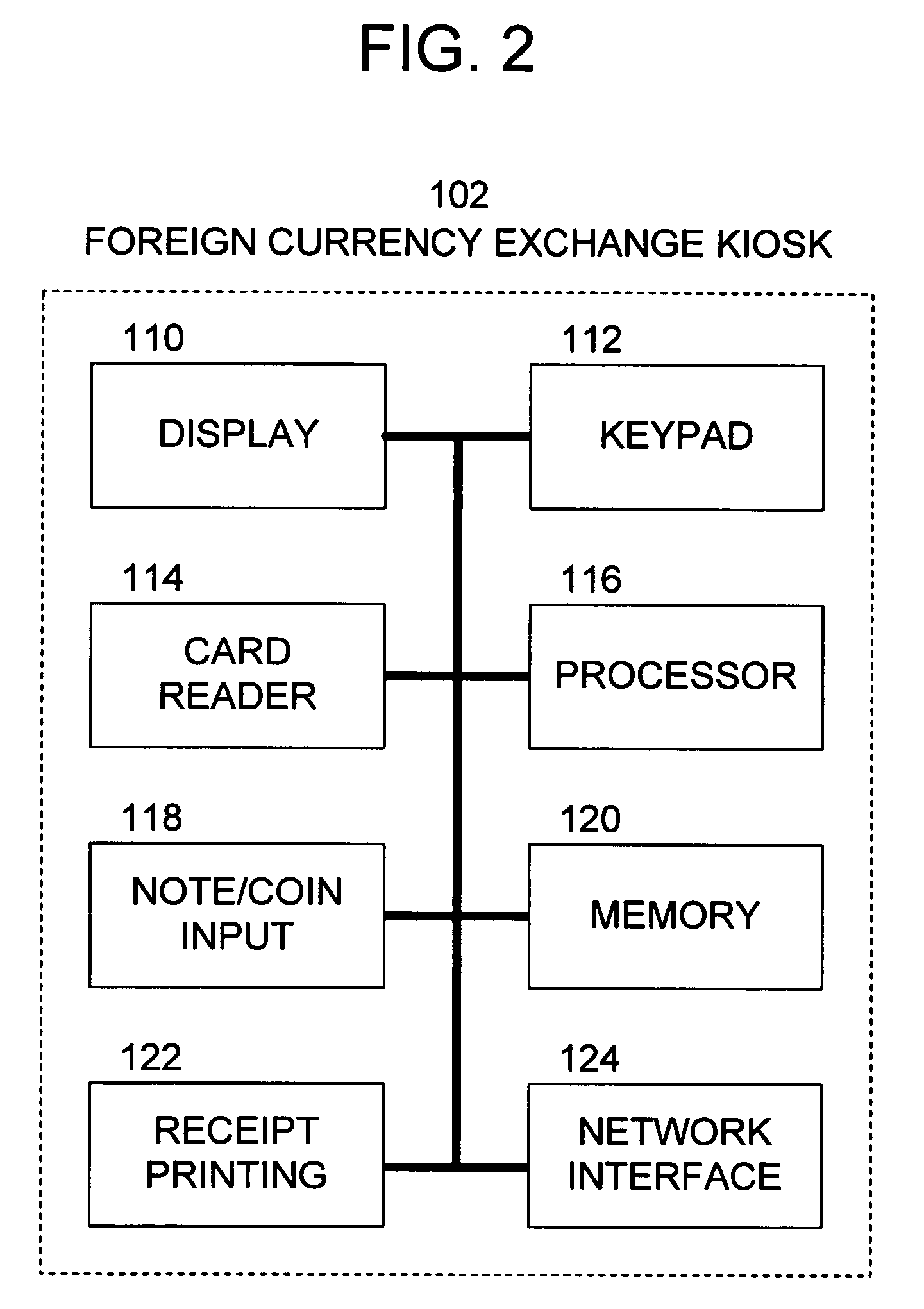

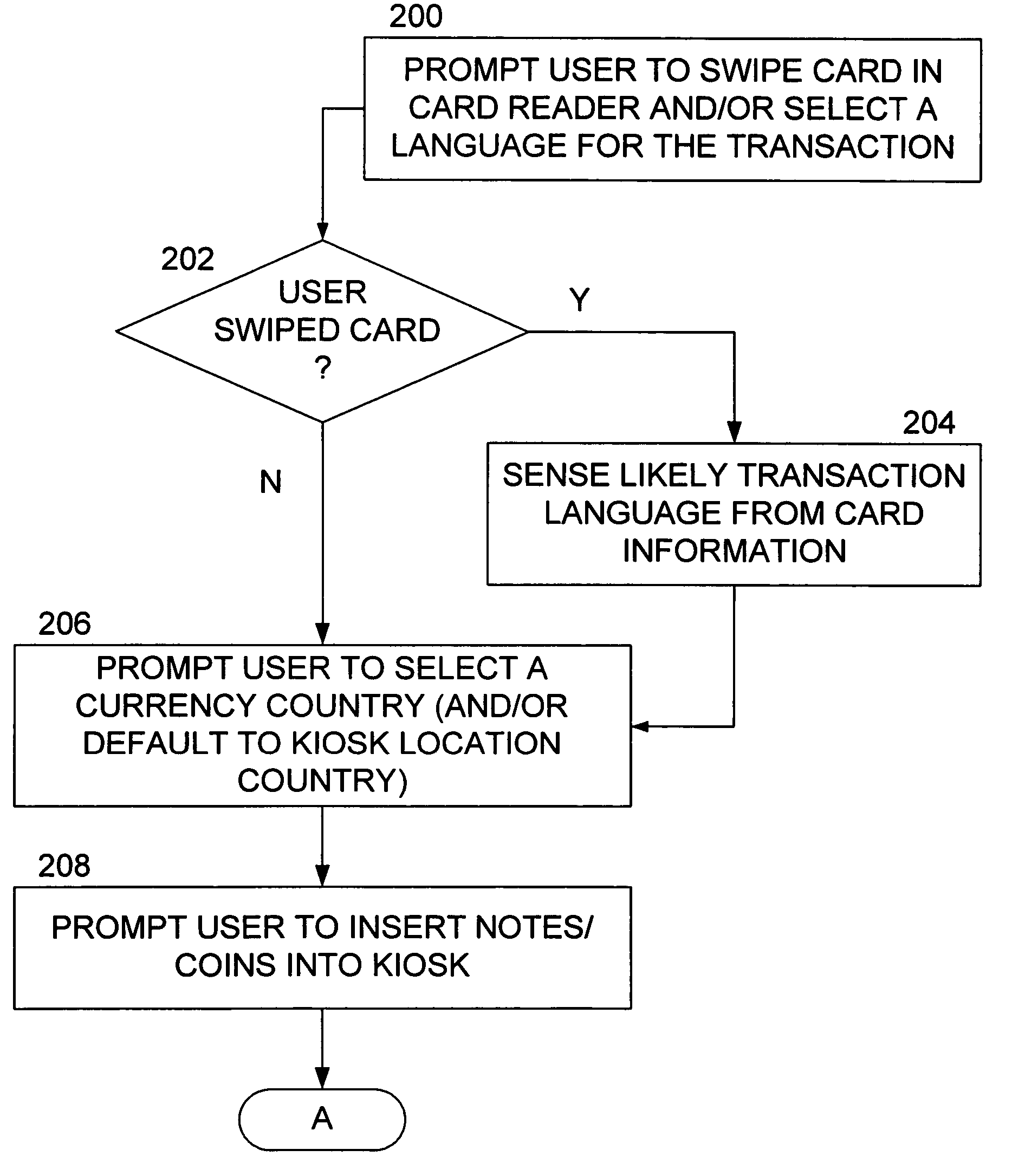

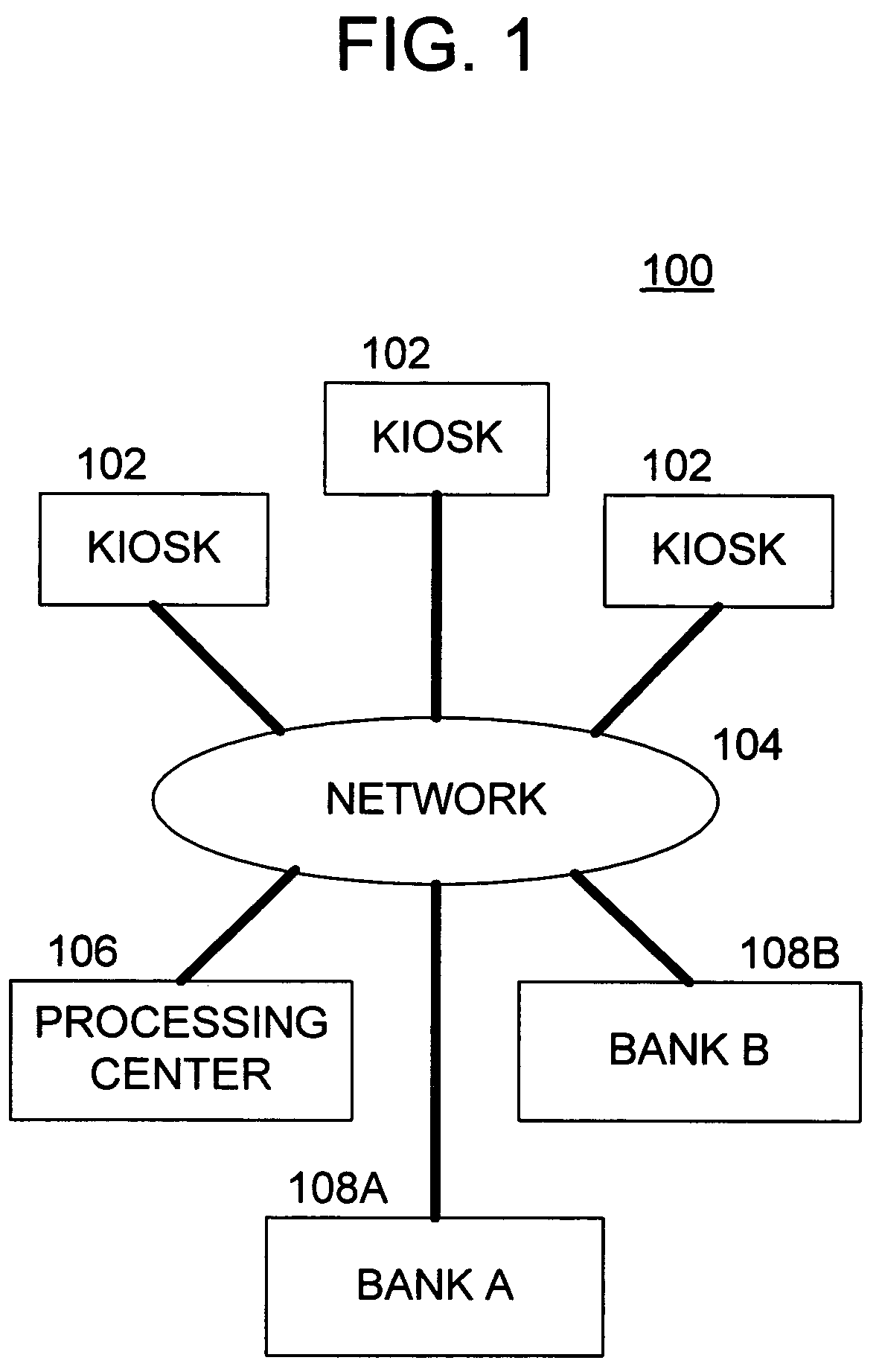

Methods and apparatus for facilitating a currency exchange transaction

Methods and apparatus for prompting a user to enter currency of a first country including at least one of notes and coins into a foreign exchange kiosk; applying one or more currency exchange rates to a total of the entered currency to compute a converted currency amount of a second country; and conducting a money transfer with a third party based on the converted currency amount.

Owner:PAE HEE CHEOL

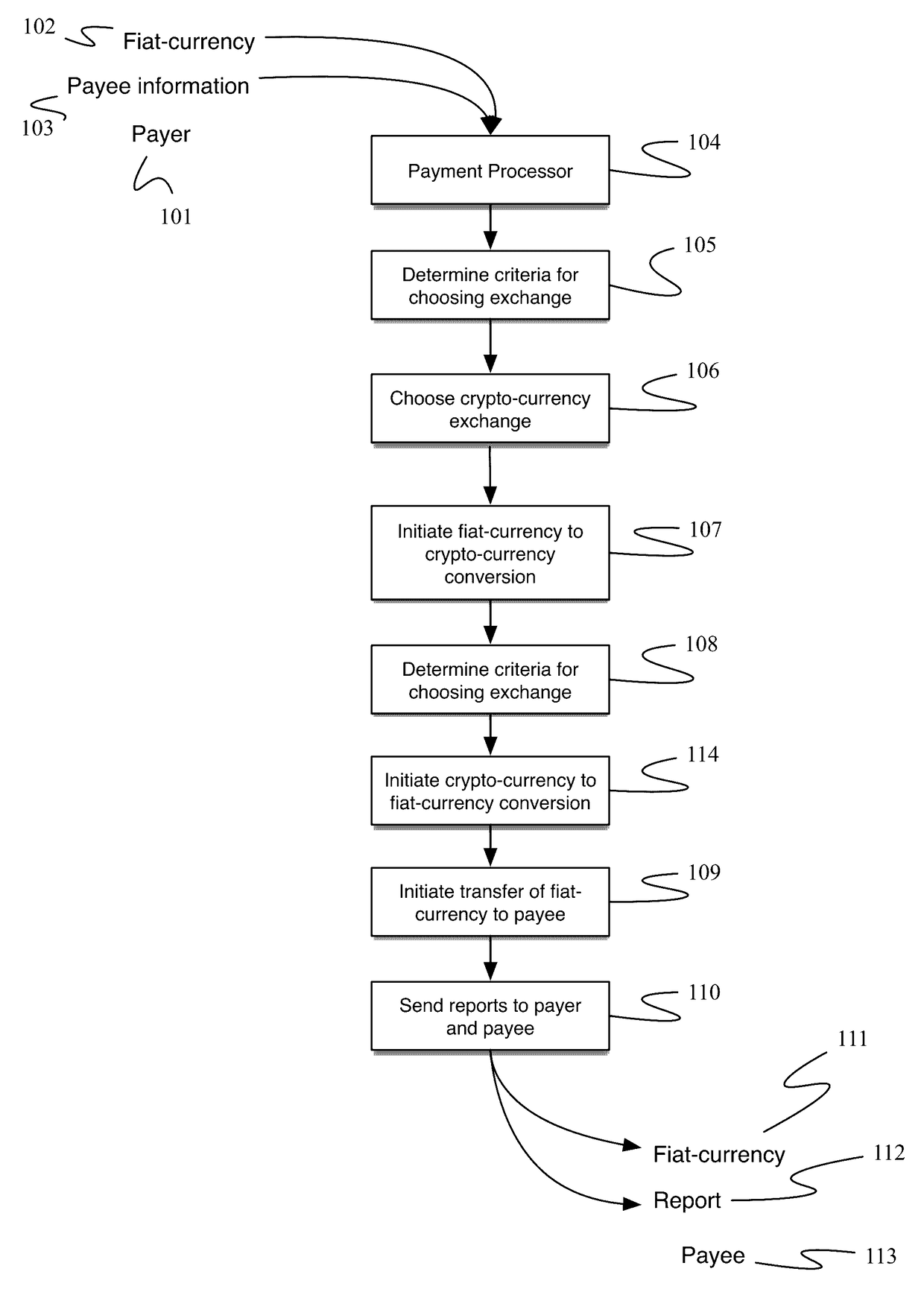

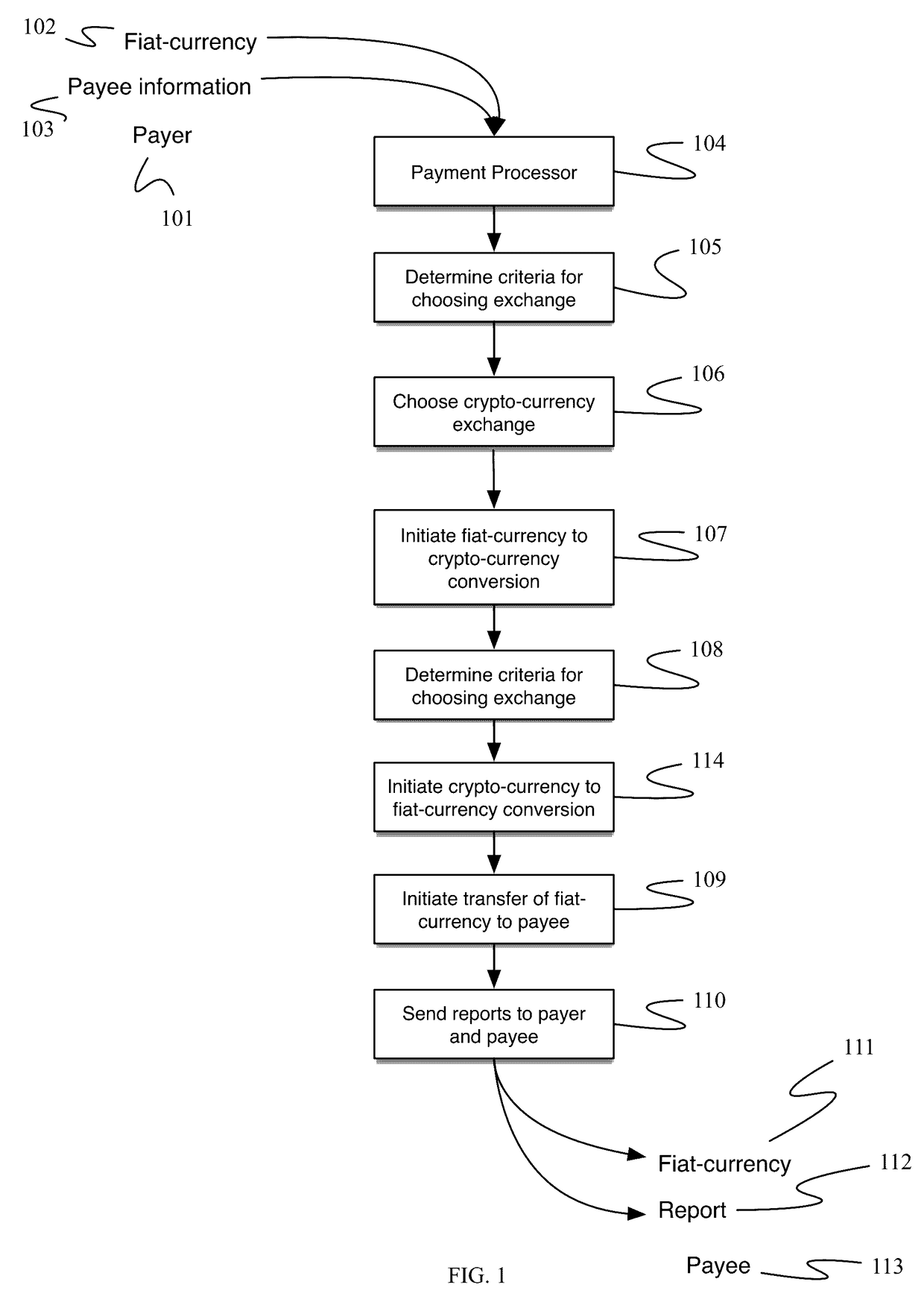

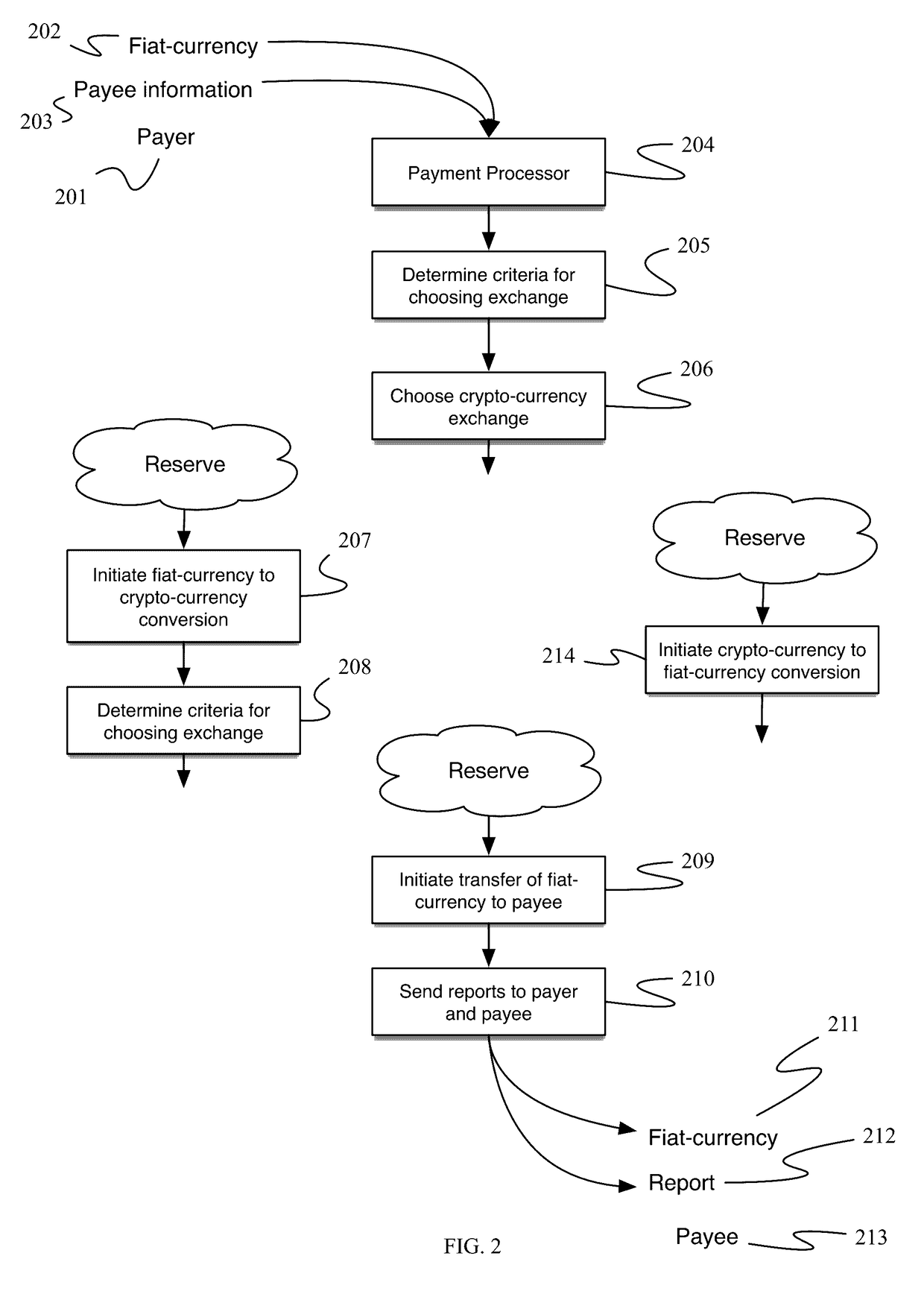

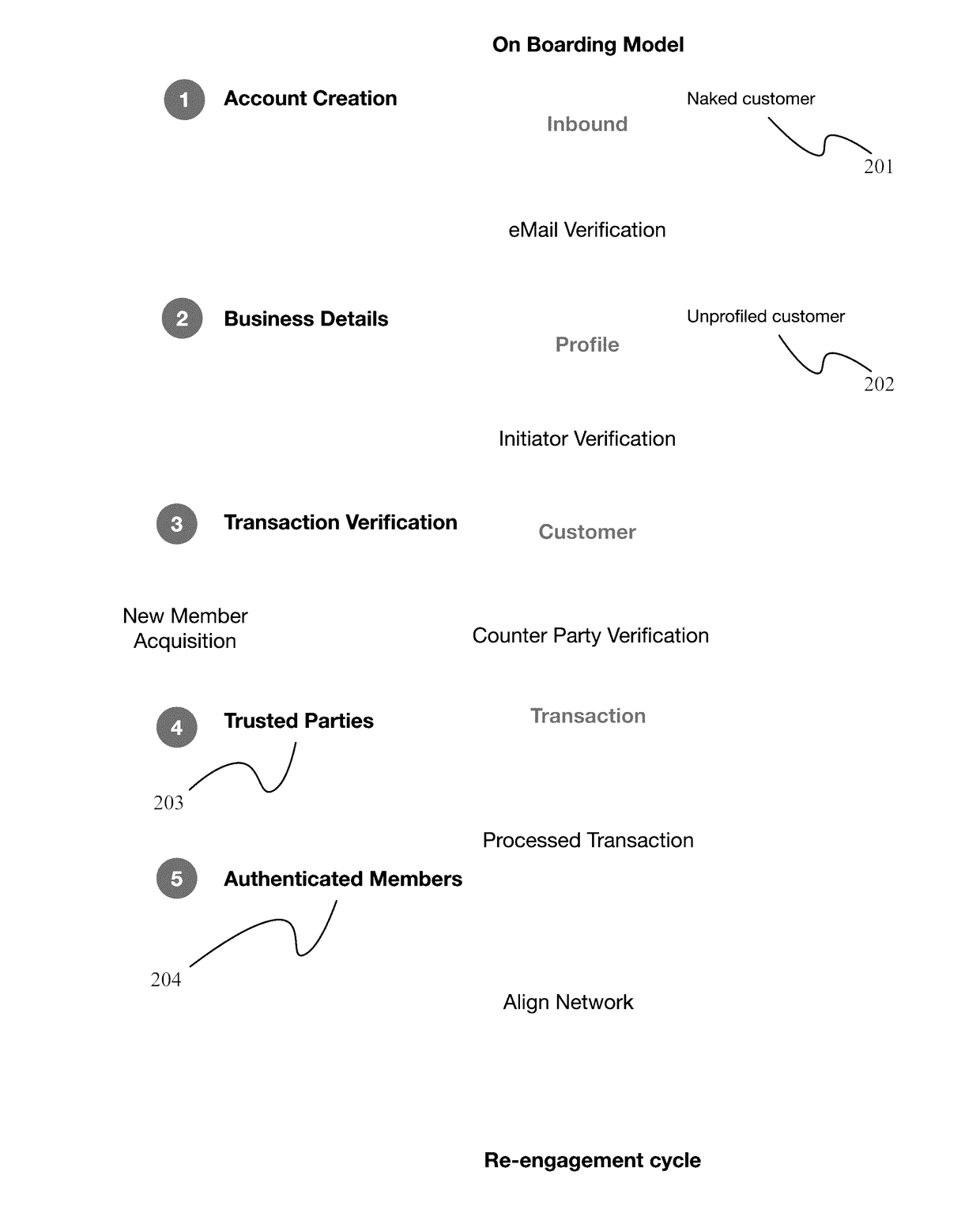

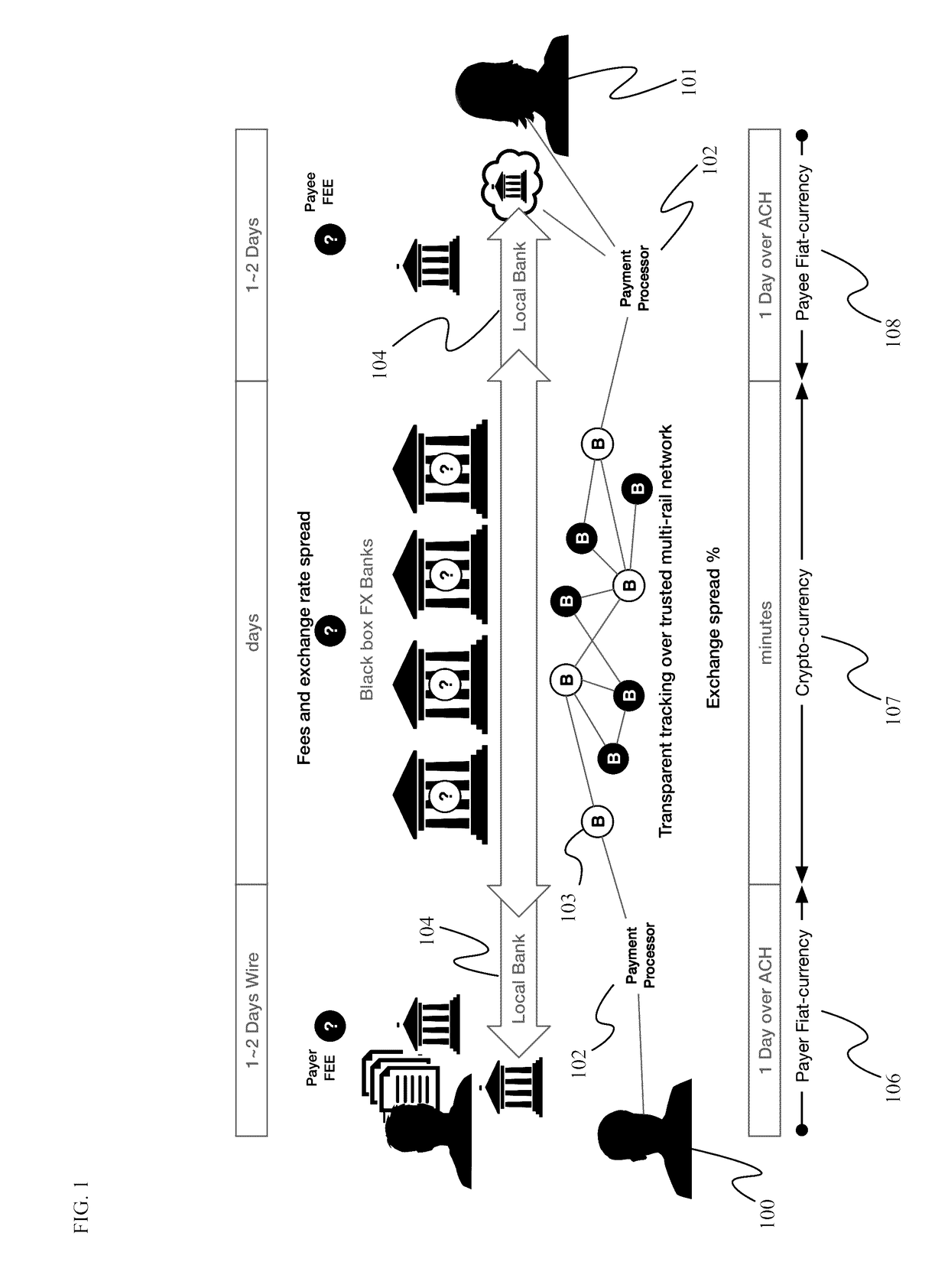

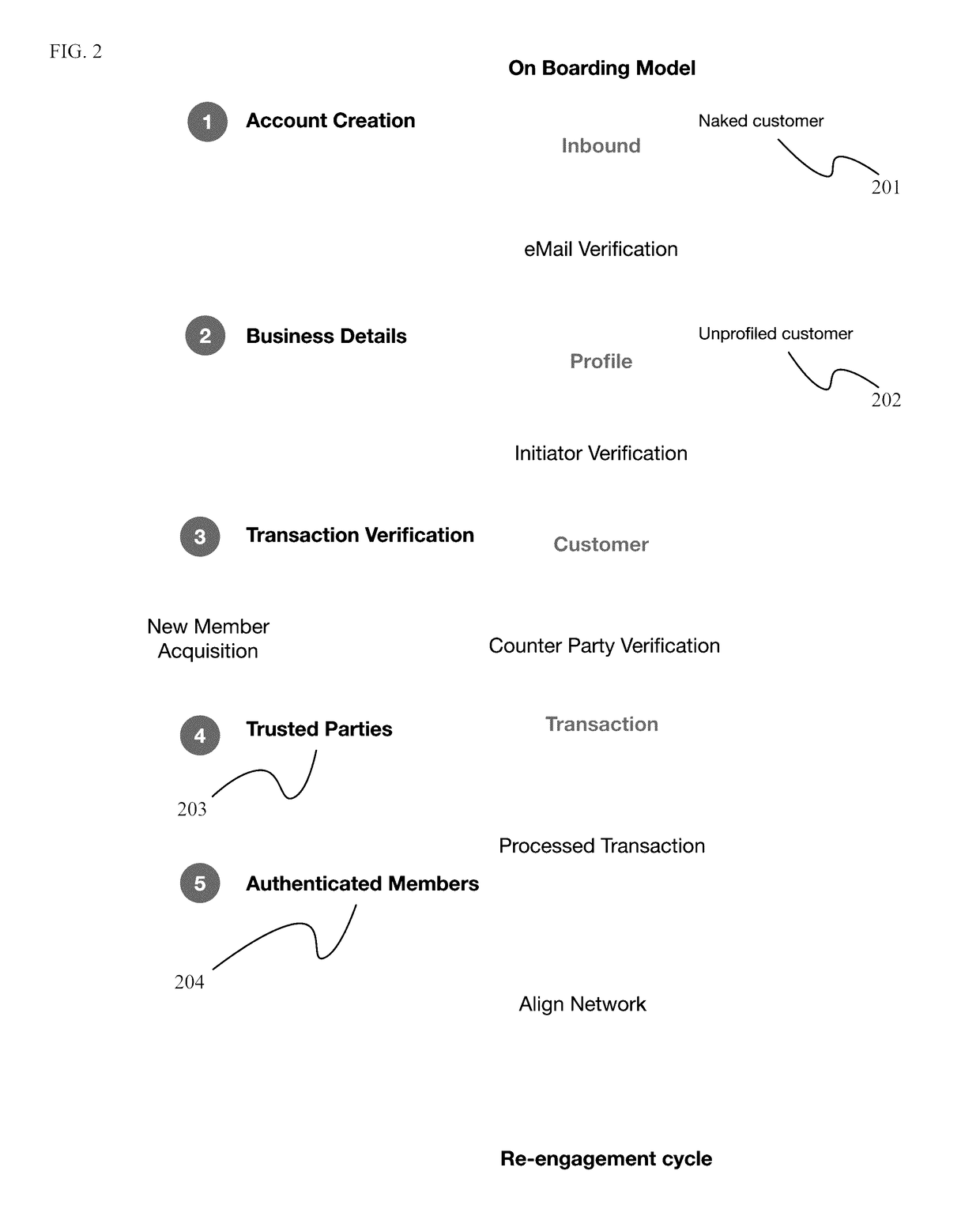

Multiple payment rail gateway and router

InactiveUS20170140371A1Cryptography processingCurrency conversionFinancial transactionCryptocurrency

A payment processor receives a first fiat-currency amount and information comprising a payee deposit destination. The payment processor receives a first plurality of criteria and evaluates a first plurality of exchanges against the first plurality of criteria to select a first transaction exchange from the first plurality of exchanges to initiate a first conversion between a first fiat-currency amount and a crypto-currency amount. The payment processor receives a second plurality of criteria and evaluates a second plurality of exchanges against the second plurality of criteria. The payment processor selects a second transaction exchange from the second plurality of exchanges to perform a second conversion between the crypto-currency amount and a second fiat-currency amount. The payment processor initiates a transfer of said second fiat-currency amount to the payee deposit destination.

Owner:VEEM

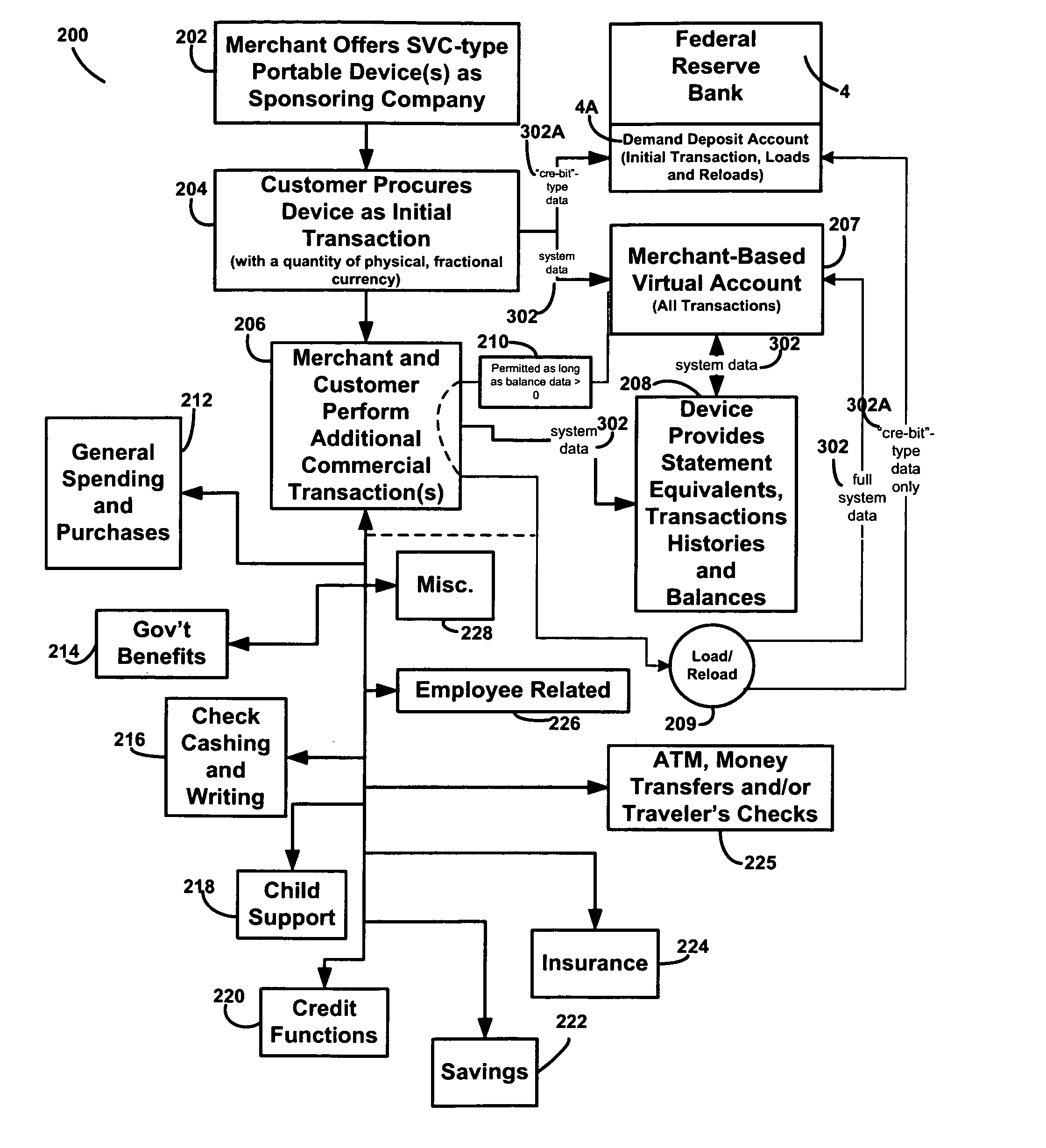

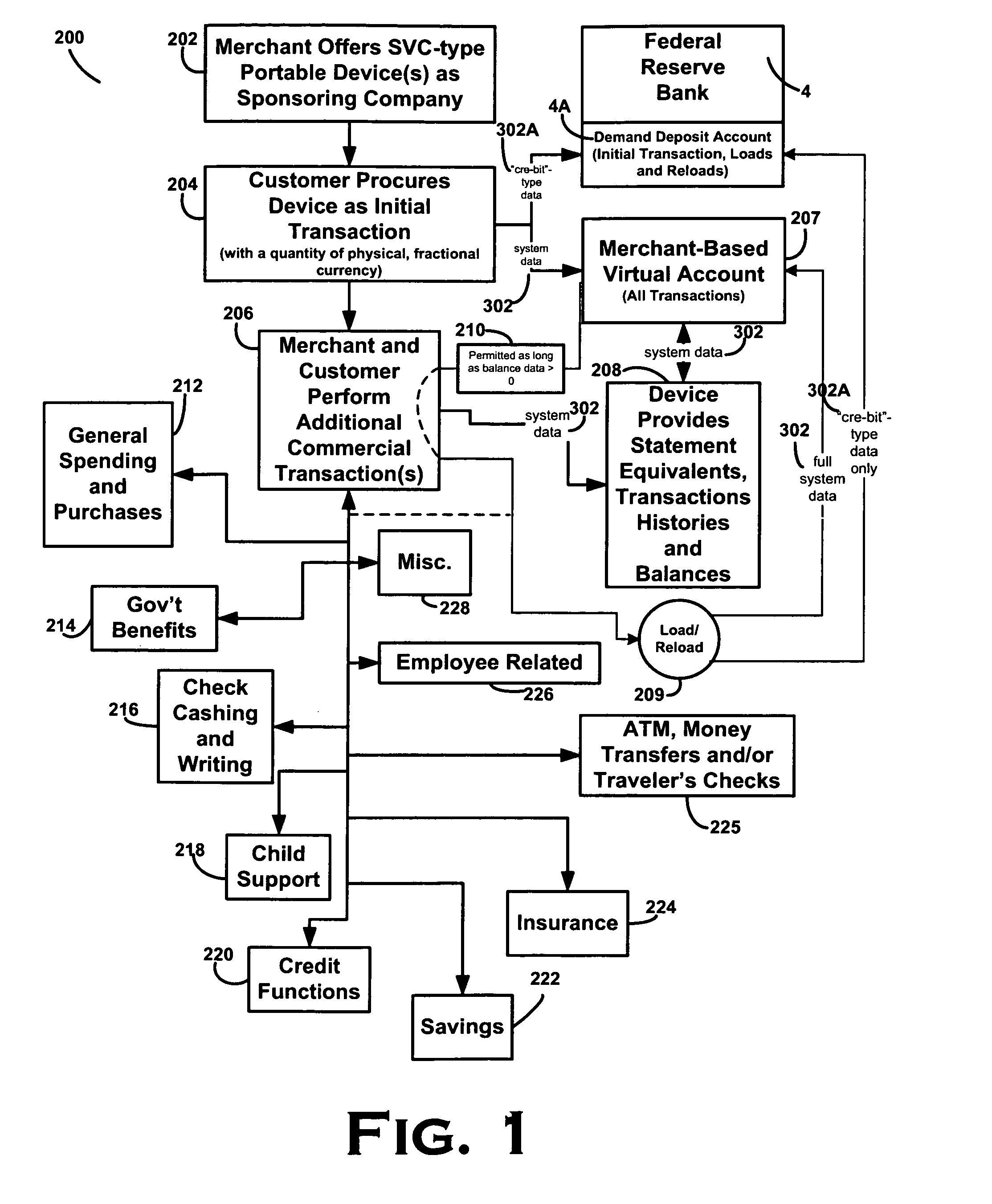

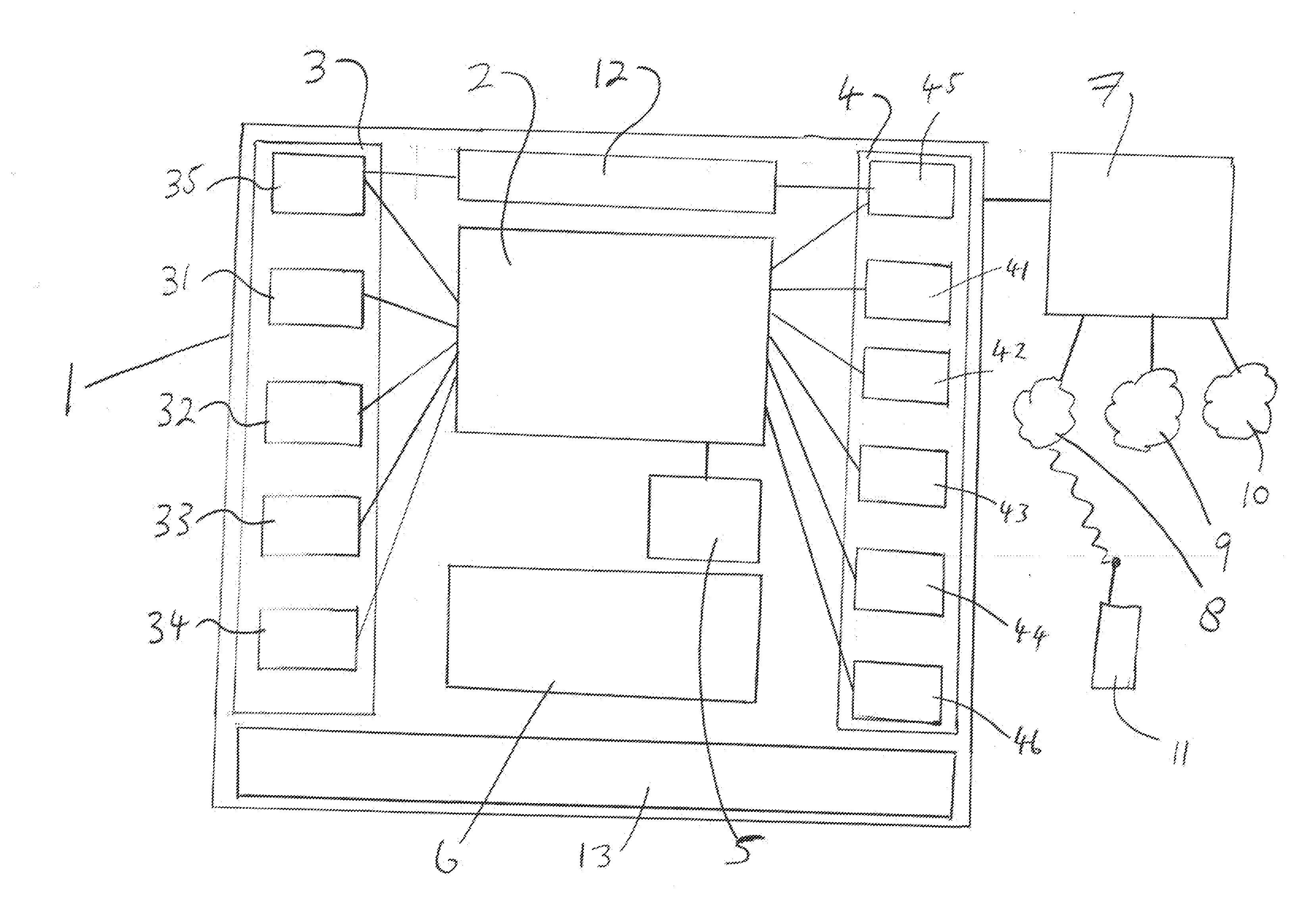

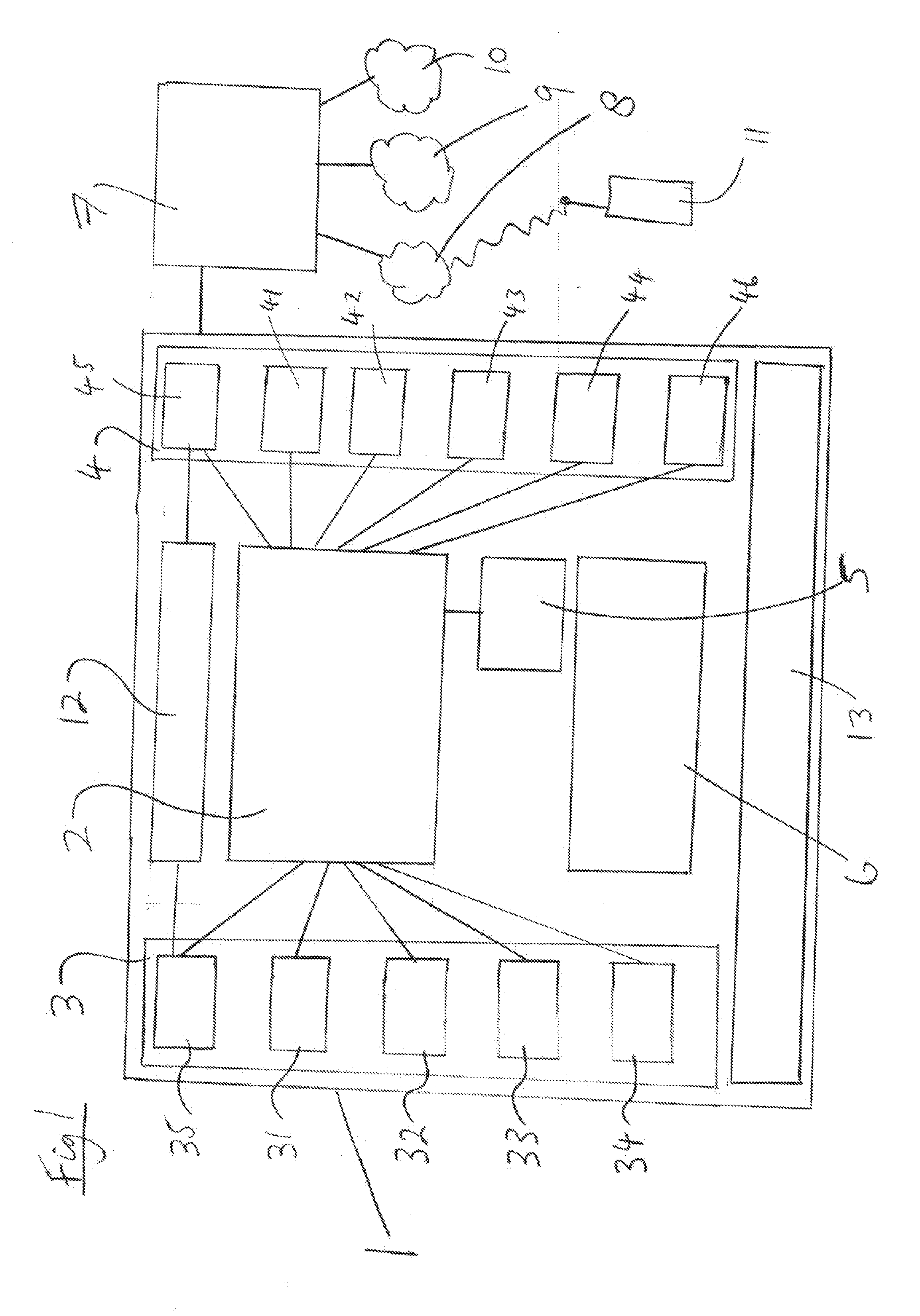

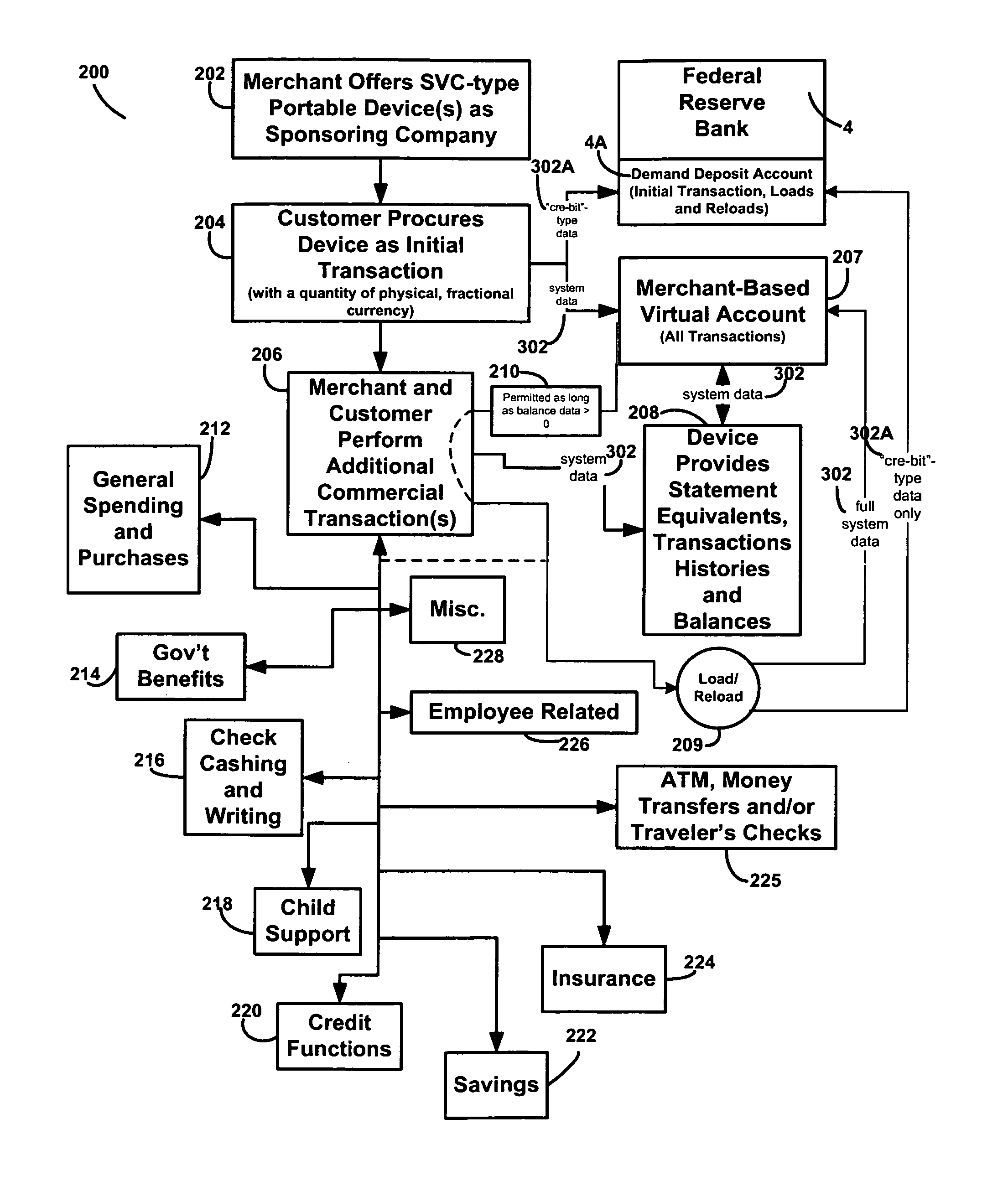

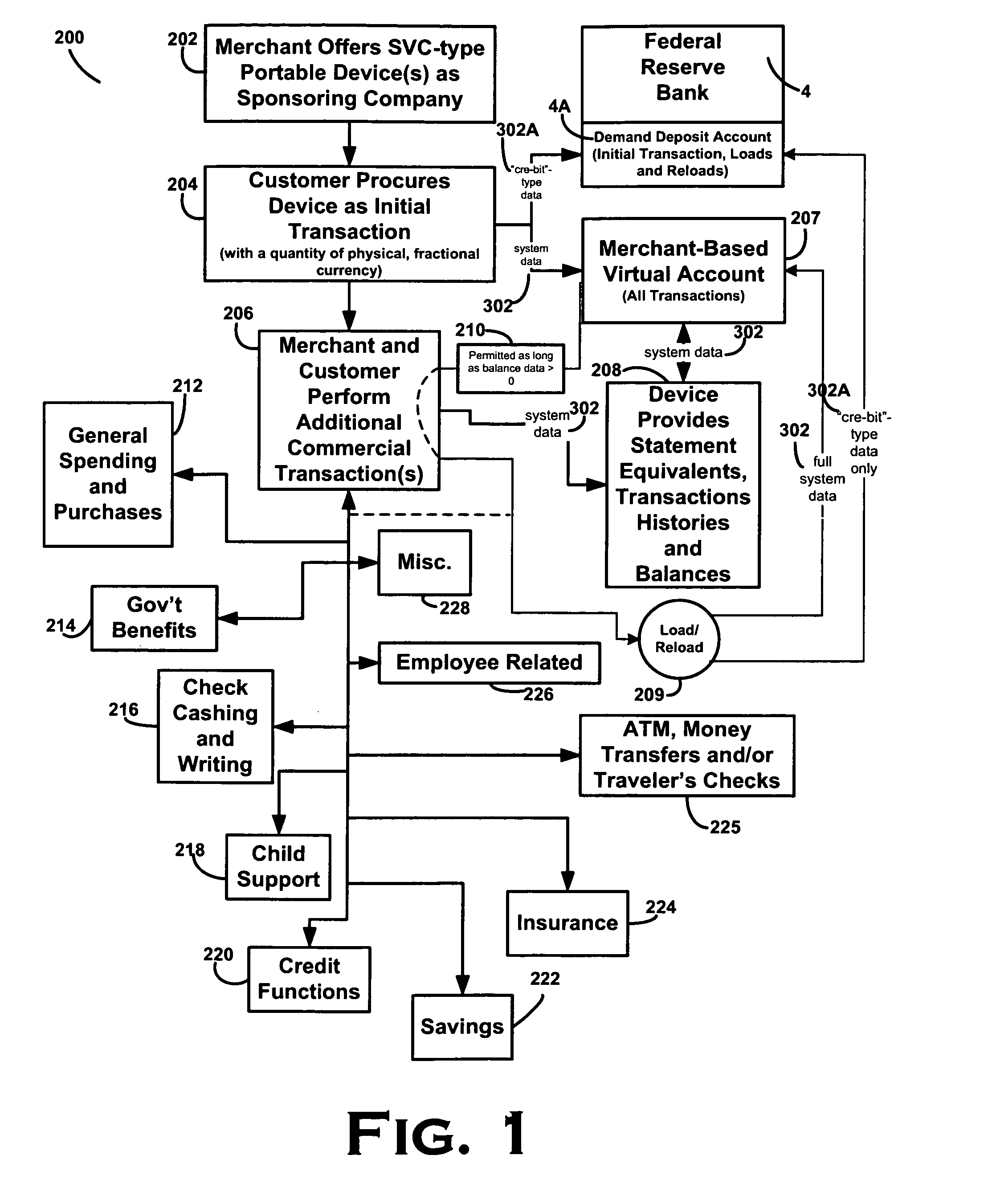

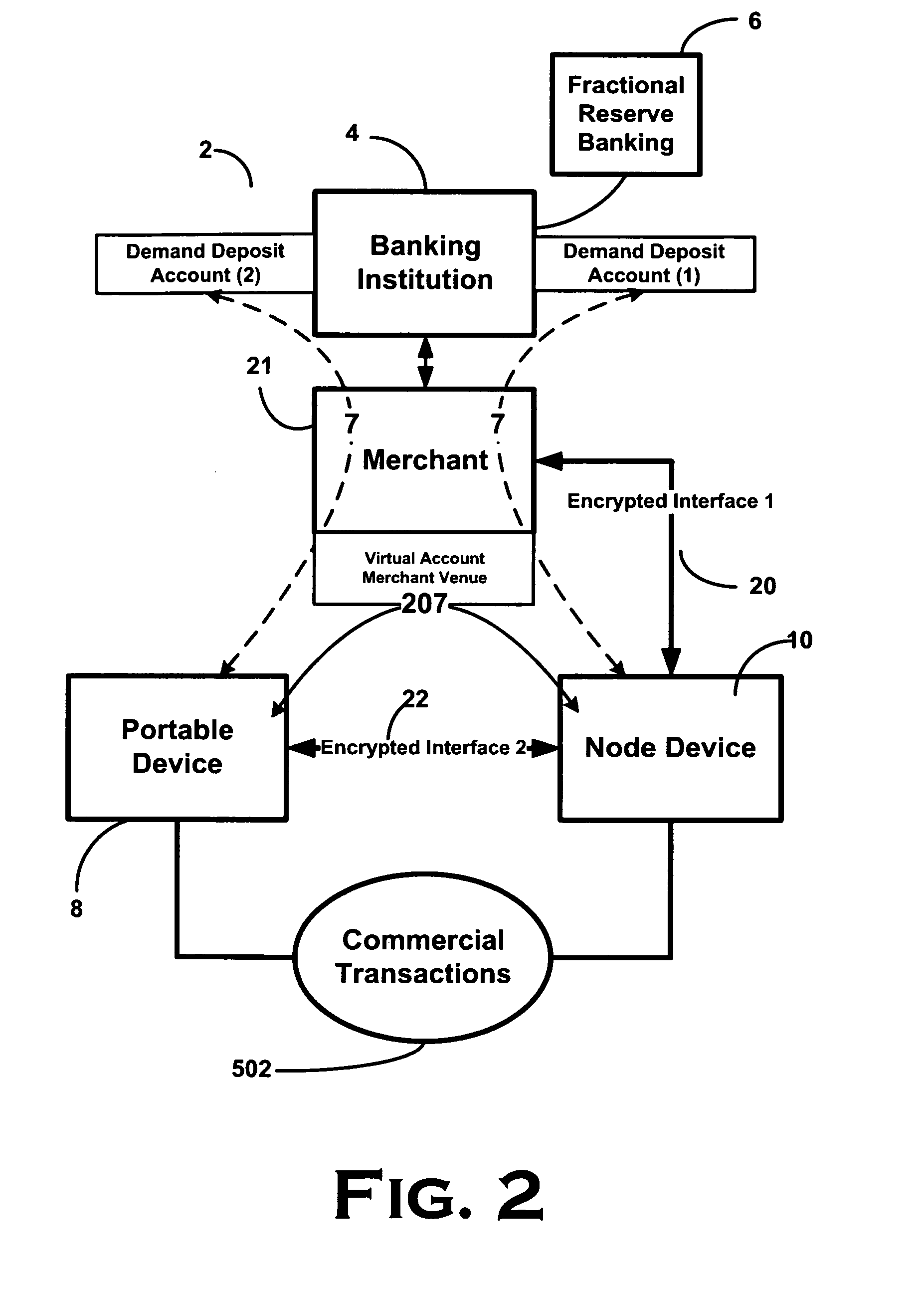

Method, system and apparatus for the establishment of a virtual banking environment in a merchant venue while increasing the deposit-based assets of optionally interfaced traditional banking institutions subject to fractional-reserve banking

ActiveUS20110112964A1Increasing deposit-based assetEliminating nuisanceComplete banking machinesFinanceEngineeringCurrency amount

A system incorporating method and associated apparatus for establishing virtual banking in a merchant venue or syndication of merchants for one or more consumers in a manner that increases the deposit-based assets of a related traditional banking institution by loading transactions of fractional currency amounts, preferably reflecting the acquisition of physical fractional currency, and more preferably coinage, and thereupon enabling inter-merchant (or syndicate) commercial transactions, including purchases and sales, in a manner that does not deplete deposit-based assets. Commercial transactions are at the direction of consumer(s) each with their own portable device linked to a merchant-hosted virtual account that maintains transaction details, histories and balances, and transmits data reflecting the same to the portable device(s) where it is recorded and displayed, upon demand. Also included are devices for executing commercial transactions with the portable device(s) and transmitting appropriate data to each bank and virtual account.

Owner:THEA FINANCIAL SERVICES

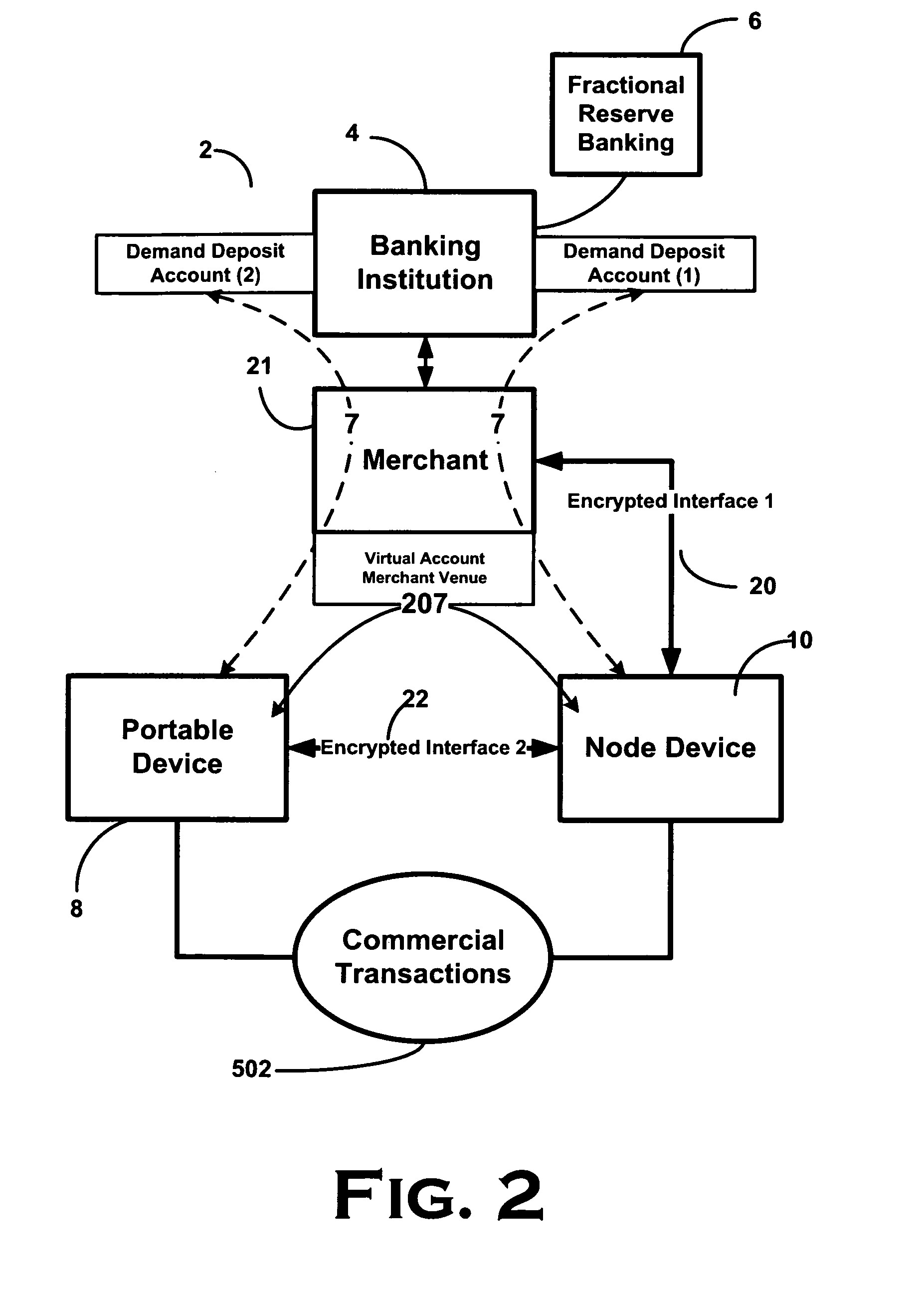

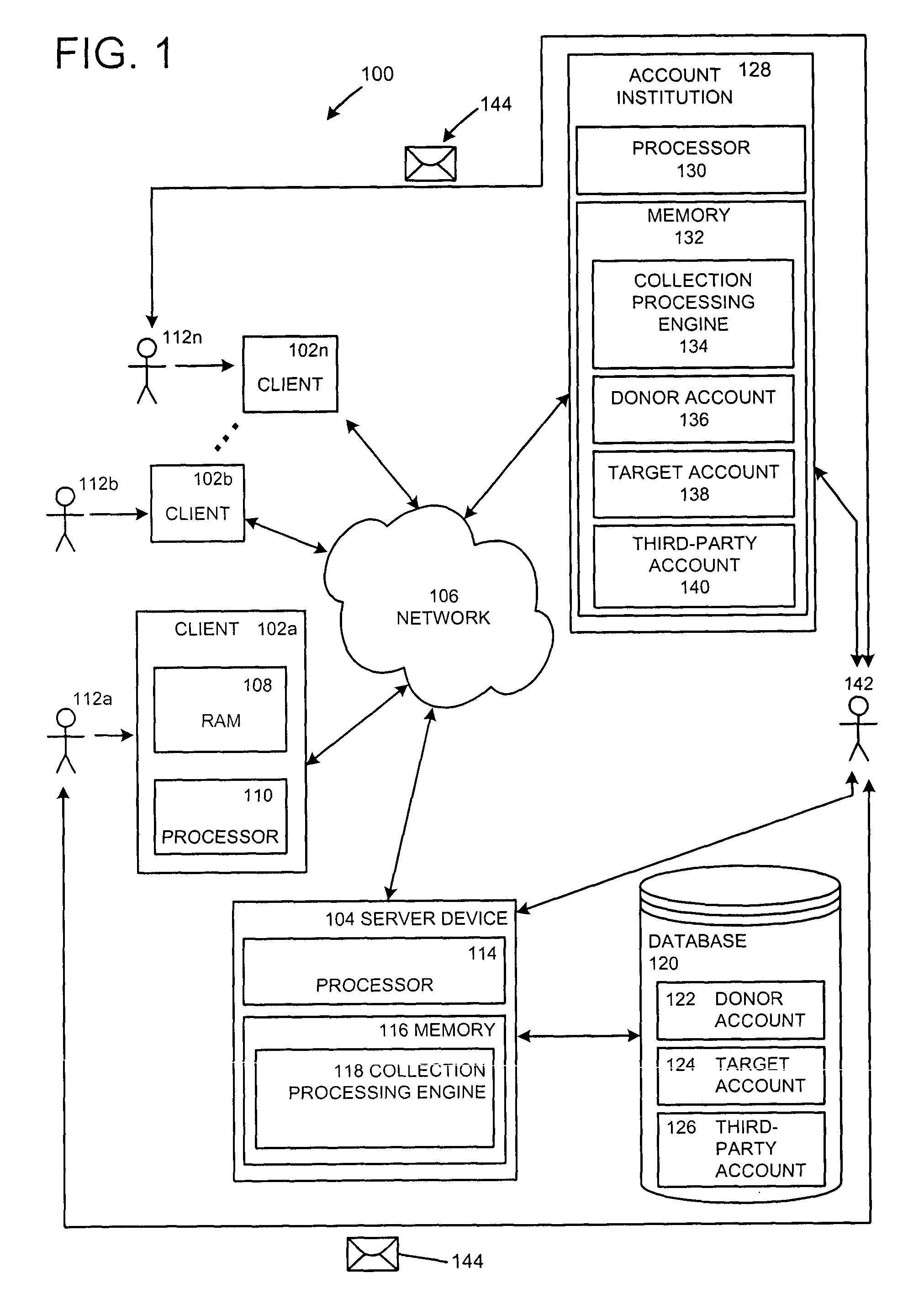

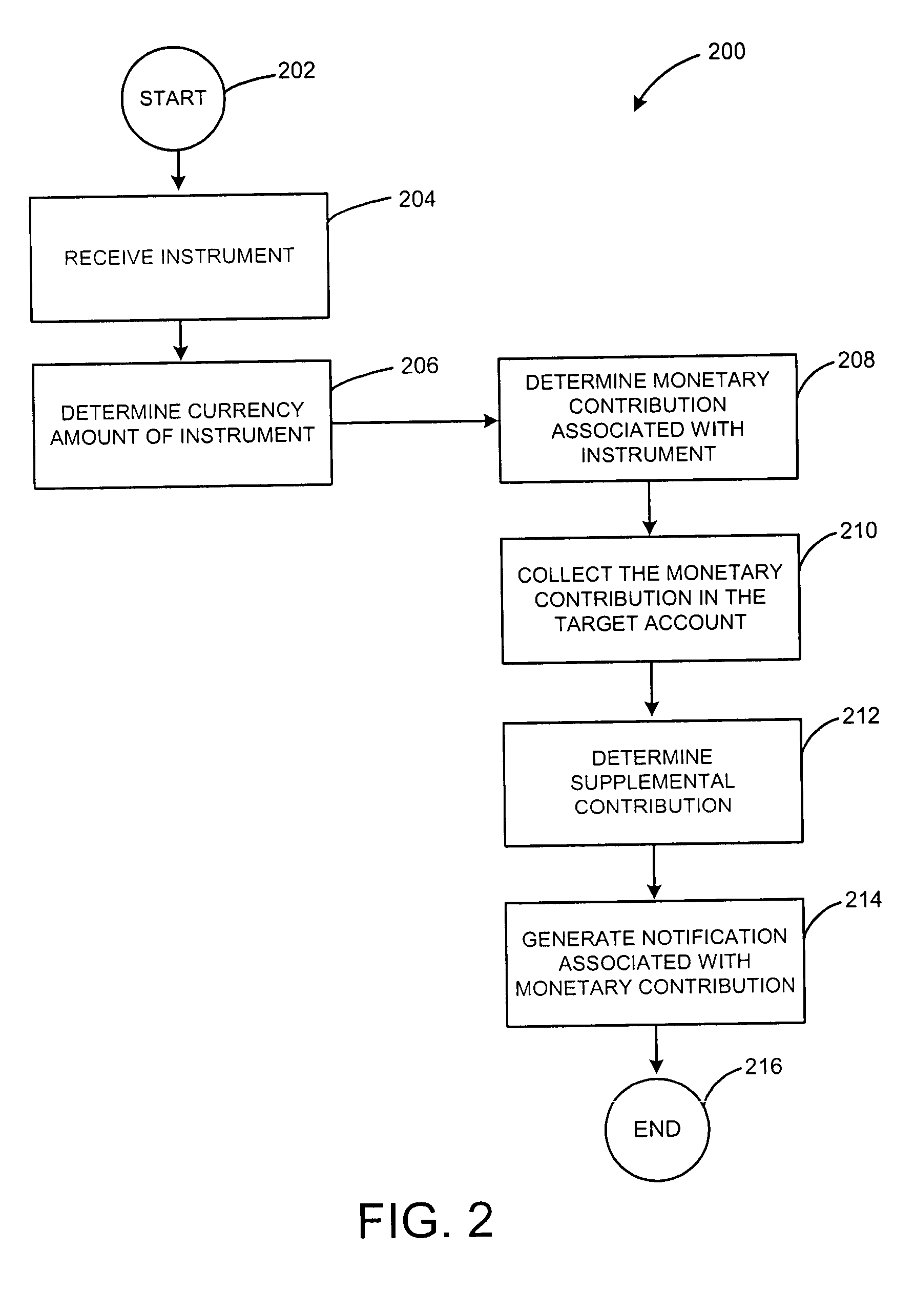

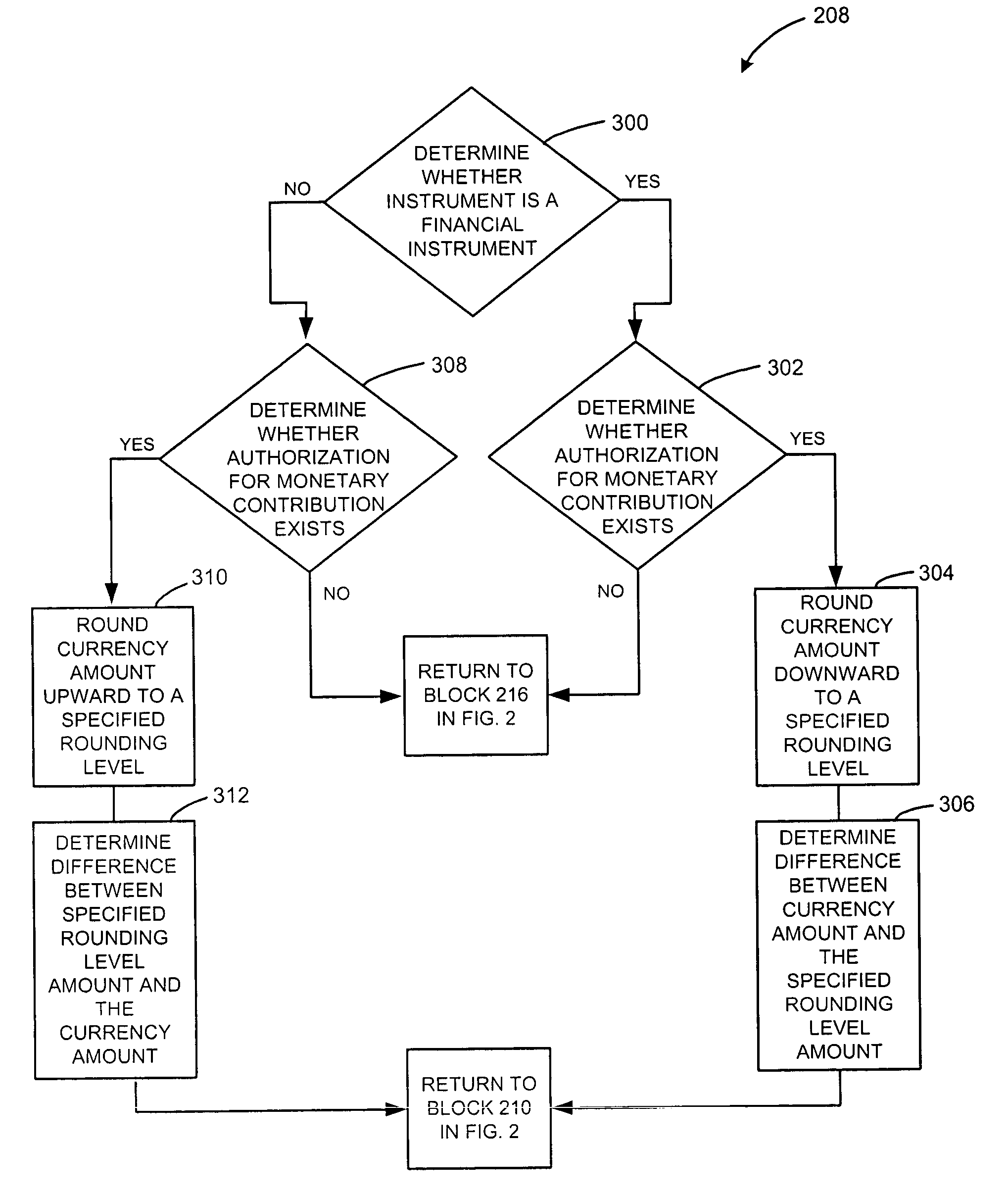

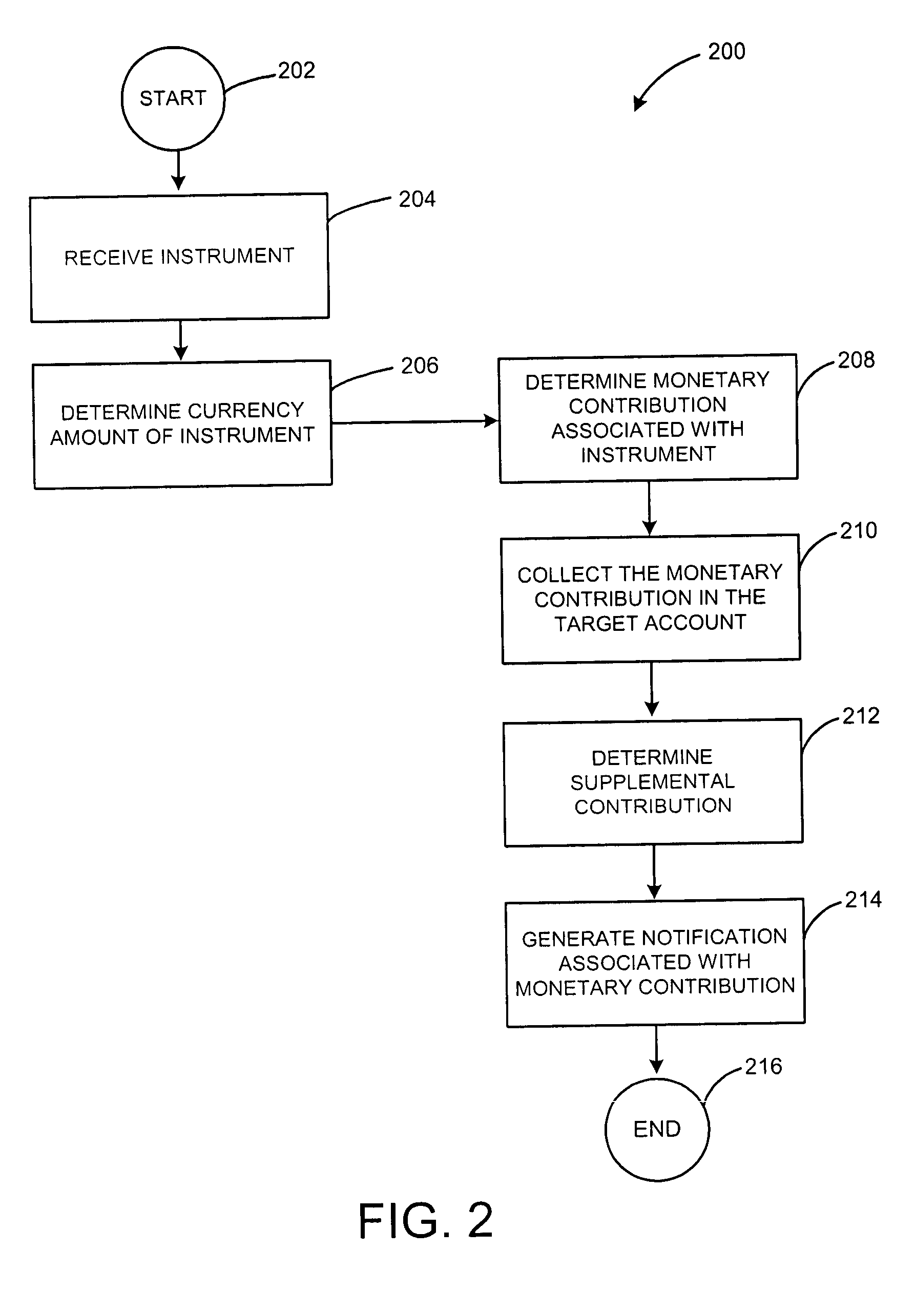

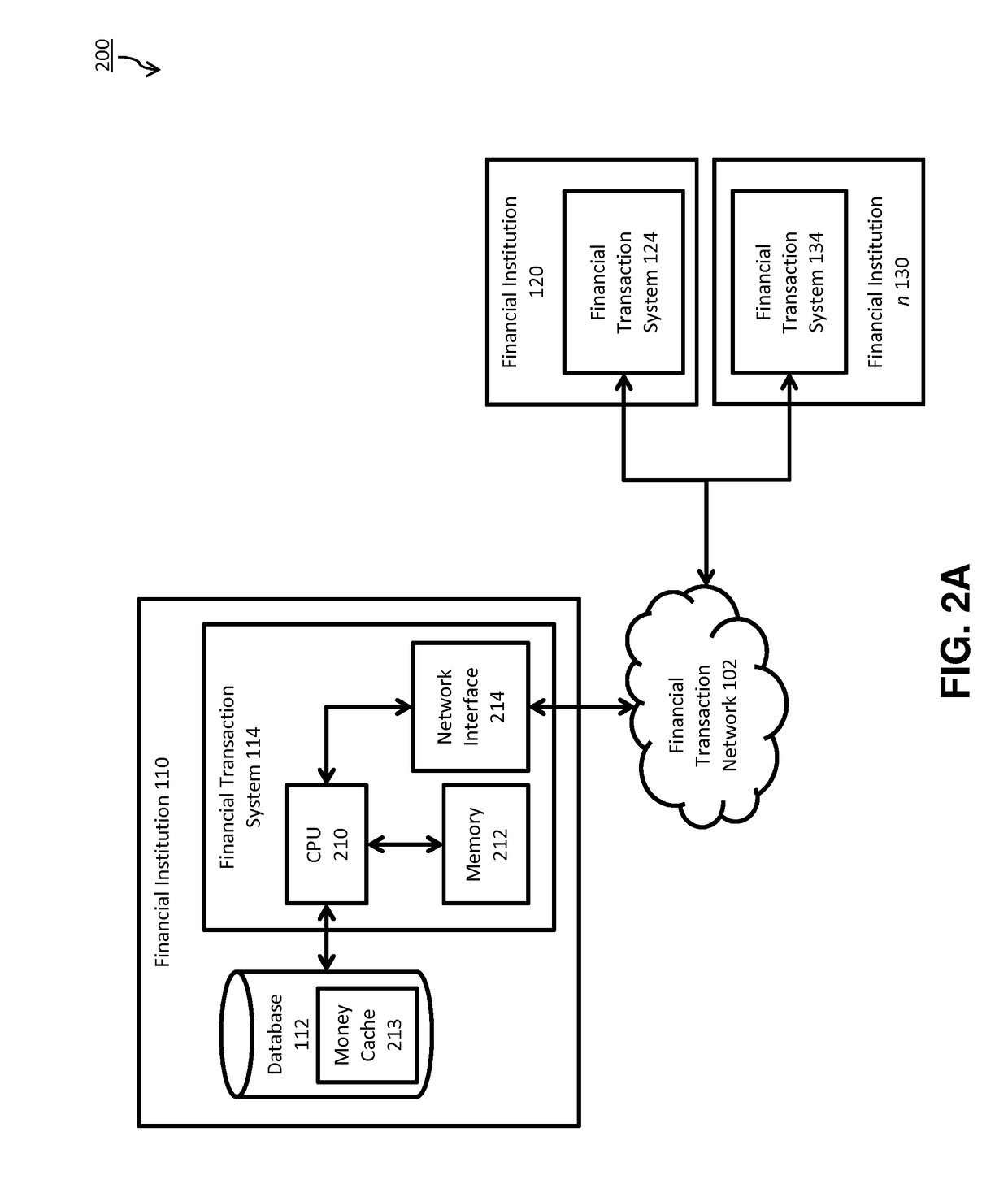

Methods and systems for automatically determining and collecting a monetary contribution from an instrument

Methods and systems are provided by embodiments of the invention for automatically determining and collecting a monetary contribution from an instrument associated with a donor. An embodiment of a method according to the invention includes receiving an instrument, determining a currency amount of the instrument, and determining a monetary contribution. To determine the monetary contribution, the method determines whether the instrument is a billing instrument or financial instrument. If the instrument is a financial instrument, the method determines whether authorization exists for a monetary contribution. If authorization exists, the method rounds the currency amount of the financial instrument downward to a lower currency amount; and determines the difference (a positive value) between the currency amount of the financial instrument and the lower currency amount, wherein the difference is the monetary contribution. If the instrument is a billing instrument, the method determines whether authorization exists for a monetary contribution. If authorization exists, the method rounds the currency amount of the billing instrument upward to a higher currency amount; and determines the difference (a positive value) between the higher currency amount and the currency amount of the billing instrument, wherein the difference is the monetary contribution. The method also collects the monetary contribution into the target account. Algorithms associated with determining a monetary contribution useful in carrying out such systems and methods are described.

Owner:RADIANT VENTURES INC

Methods and systems for automatically determining and collecting a monetary contribution from an instrument

Methods and systems are provided for automatically determining and collecting a monetary contribution from an instrument associated with a donor. An embodiment of a method according to the invention includes receiving an instrument, determining a currency amount of the instrument, and determining a monetary contribution. If the instrument is a financial instrument, the method rounds the currency amount of the financial instrument downward to a lower currency amount; and determines the difference (a positive value) between the amount of the financial instrument and the lower currency amount for the monetary contribution. If the instrument is a billing instrument, the method rounds the currency amount of the billing instrument upward to a higher currency amount; and determines the difference (a positive value) between the higher currency amount and the amount of the billing instrument for the monetary contribution. The method also collects the monetary contribution into the target account.

Owner:RADIANT VENTURES INC

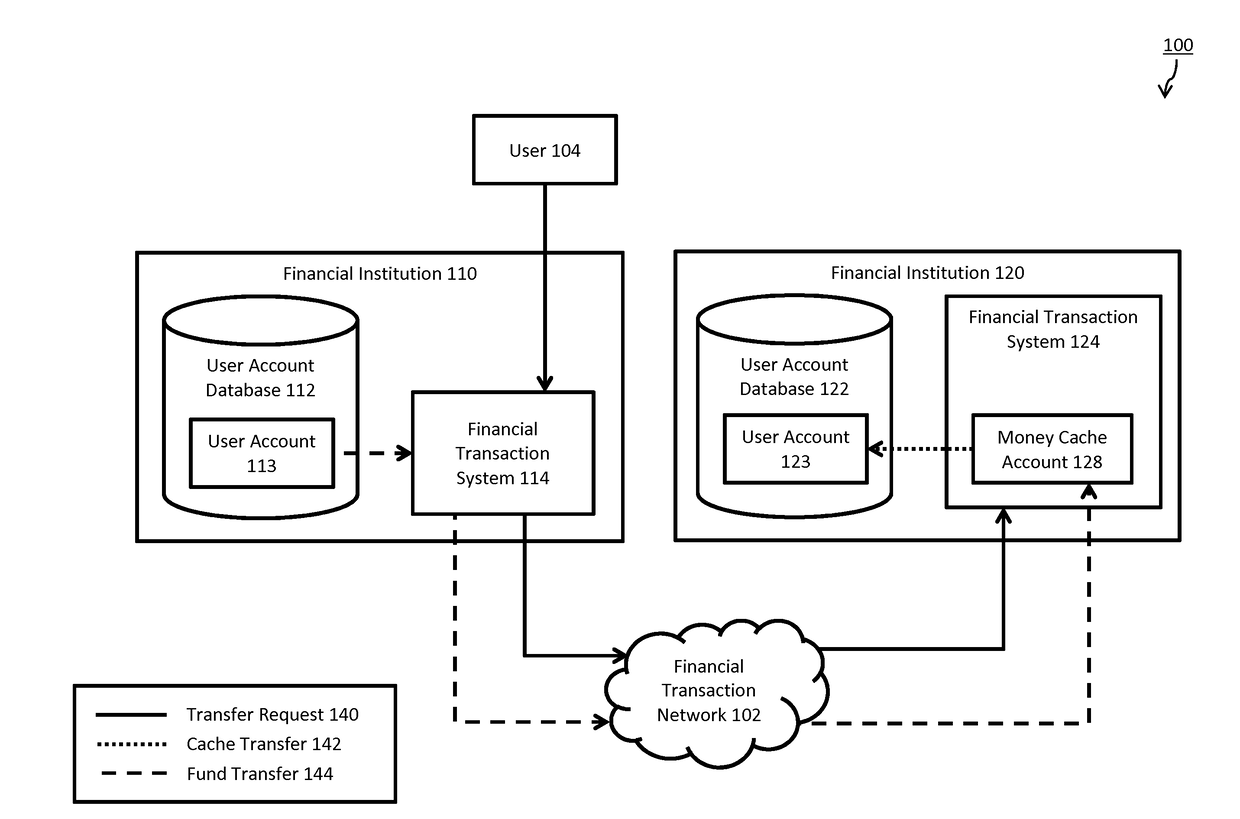

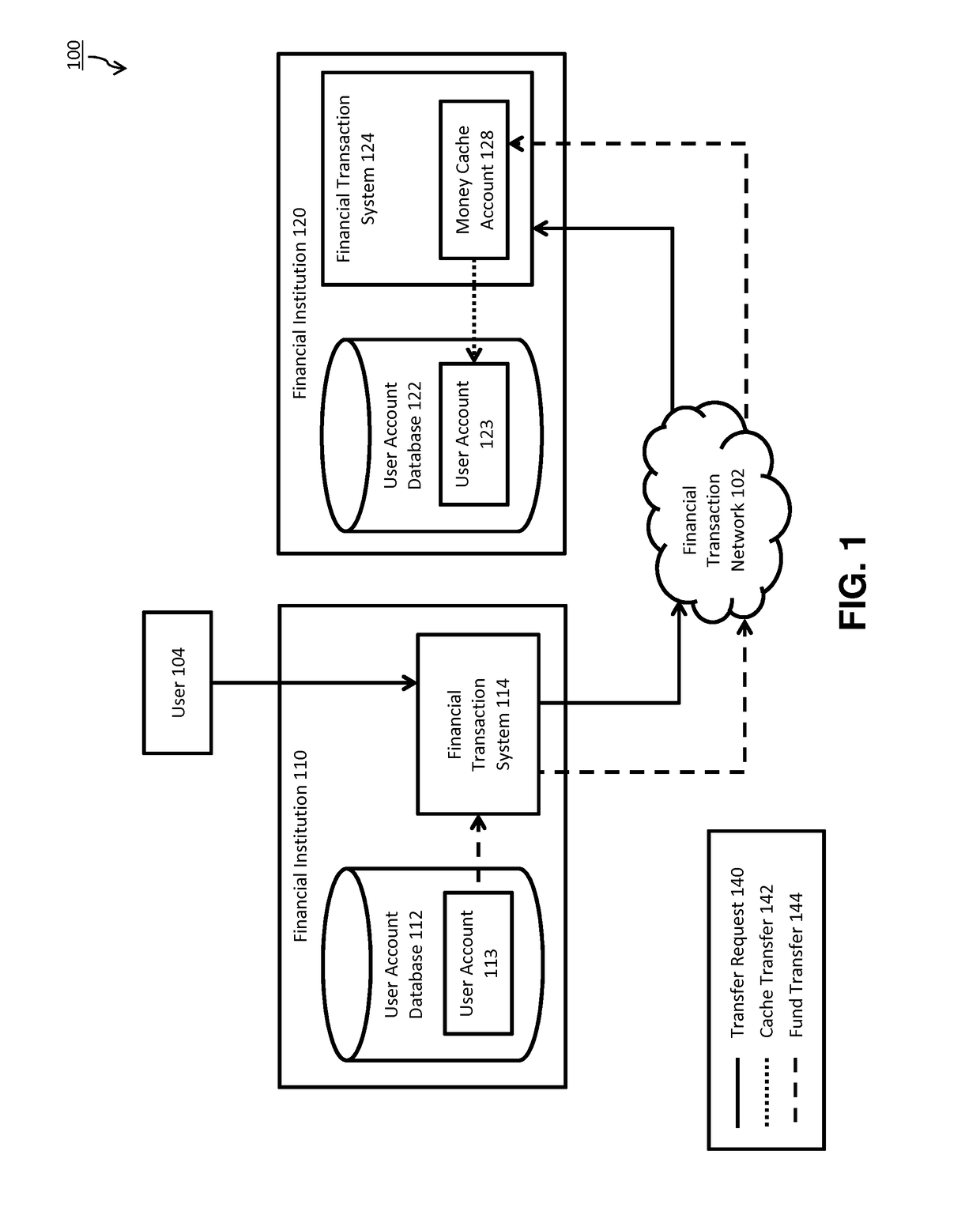

Faster cross border remittances using crowd sourced funding cache

Systems and methods for accelerating availability of funds involved in a money transfer from a first user account at a first financial institution to a second user account at a second financial institution. An example method includes receiving a first message from the first financial institution that indicates intent to transfer a monetary amount from the first user account to the second user account. Upon receiving the message, it is determined whether the second user account is associated with a money cache account and if so, transferring at least a portion of the indicated monetary amount from the money cache account to the second user account. At a later time, a second message is received from the first financial institution that includes the monetary amount to be transferred. The second message is processed by transferring at least a portion of the received monetary amount to the money cache account.

Owner:PAYPAL INC

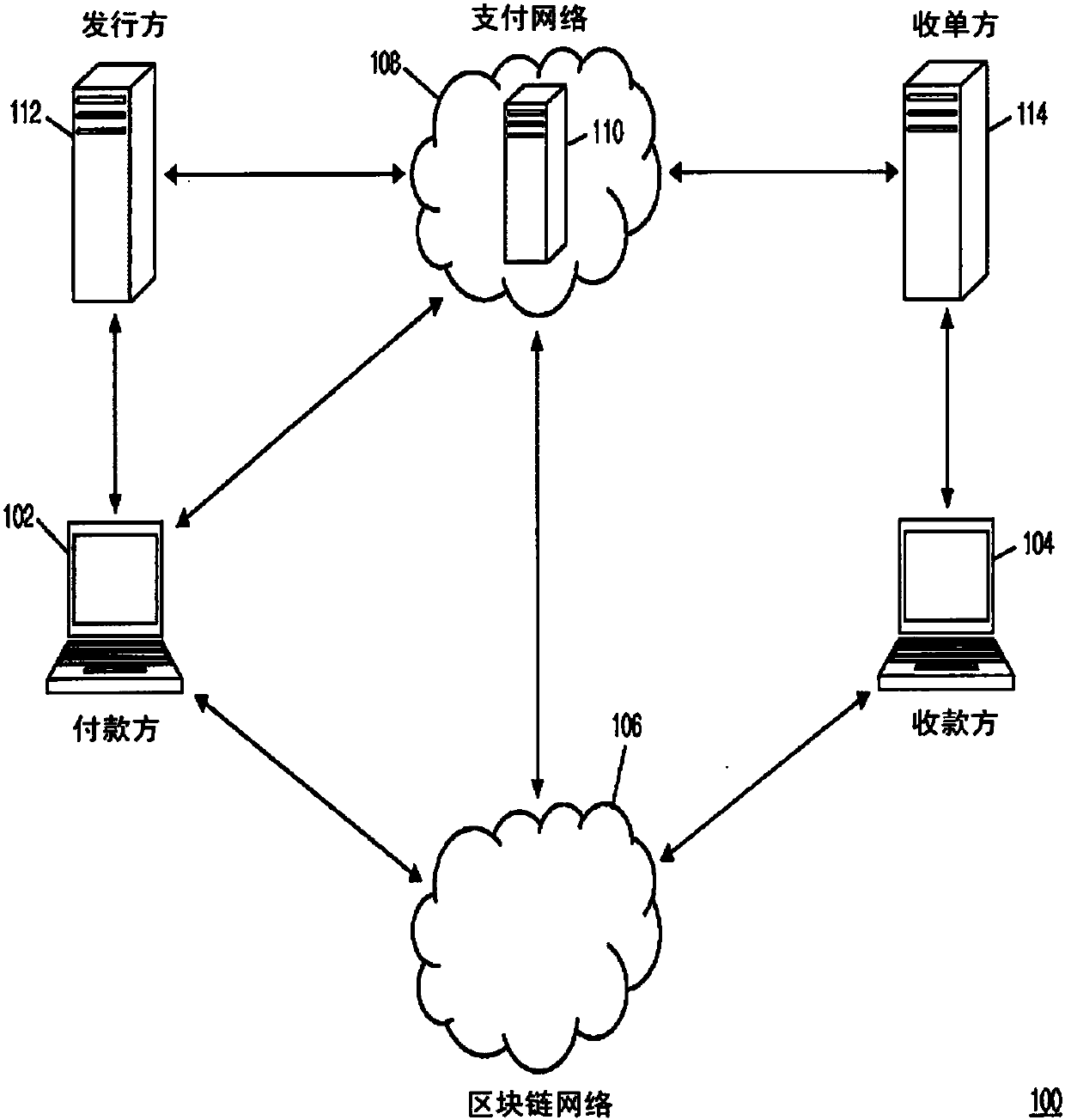

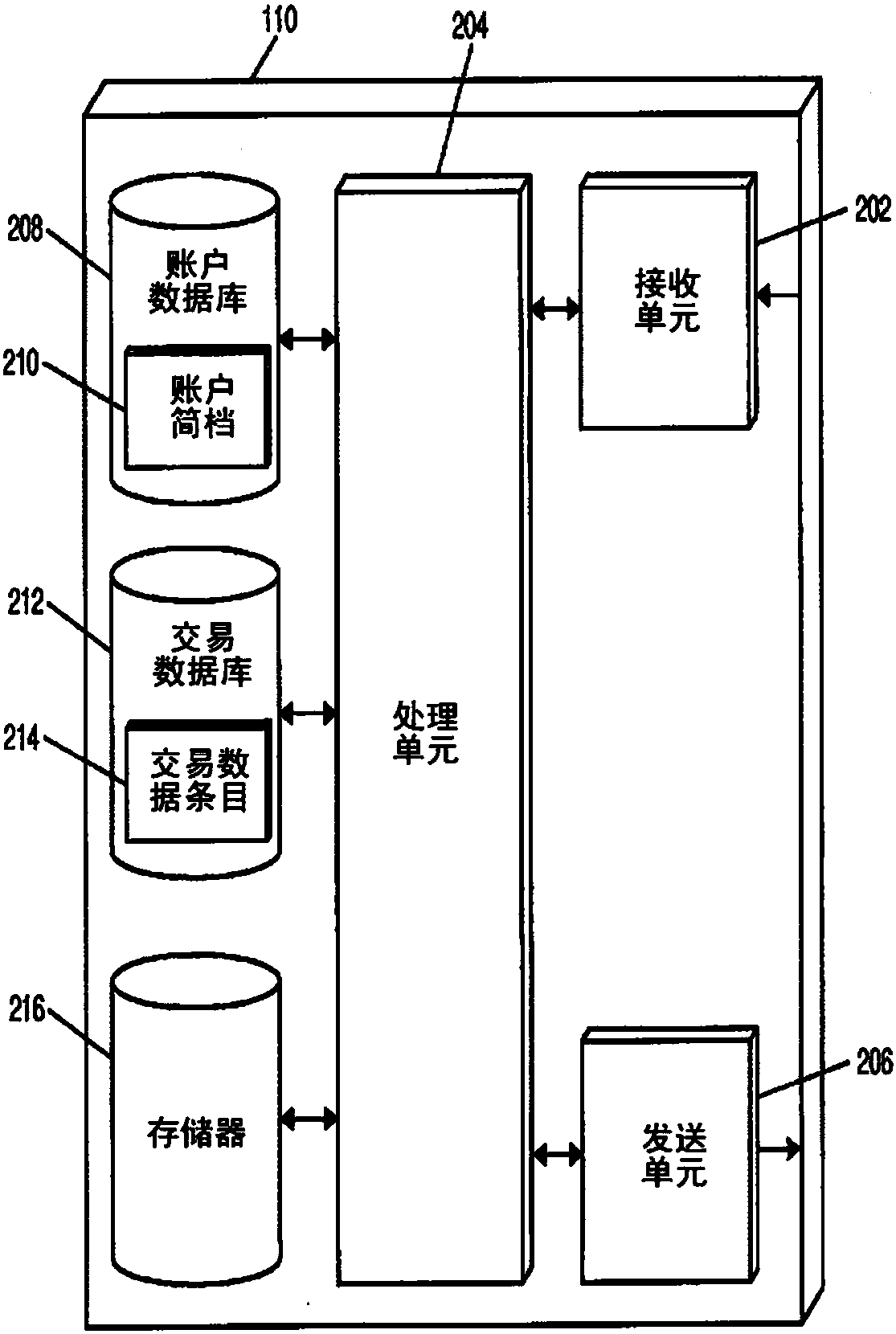

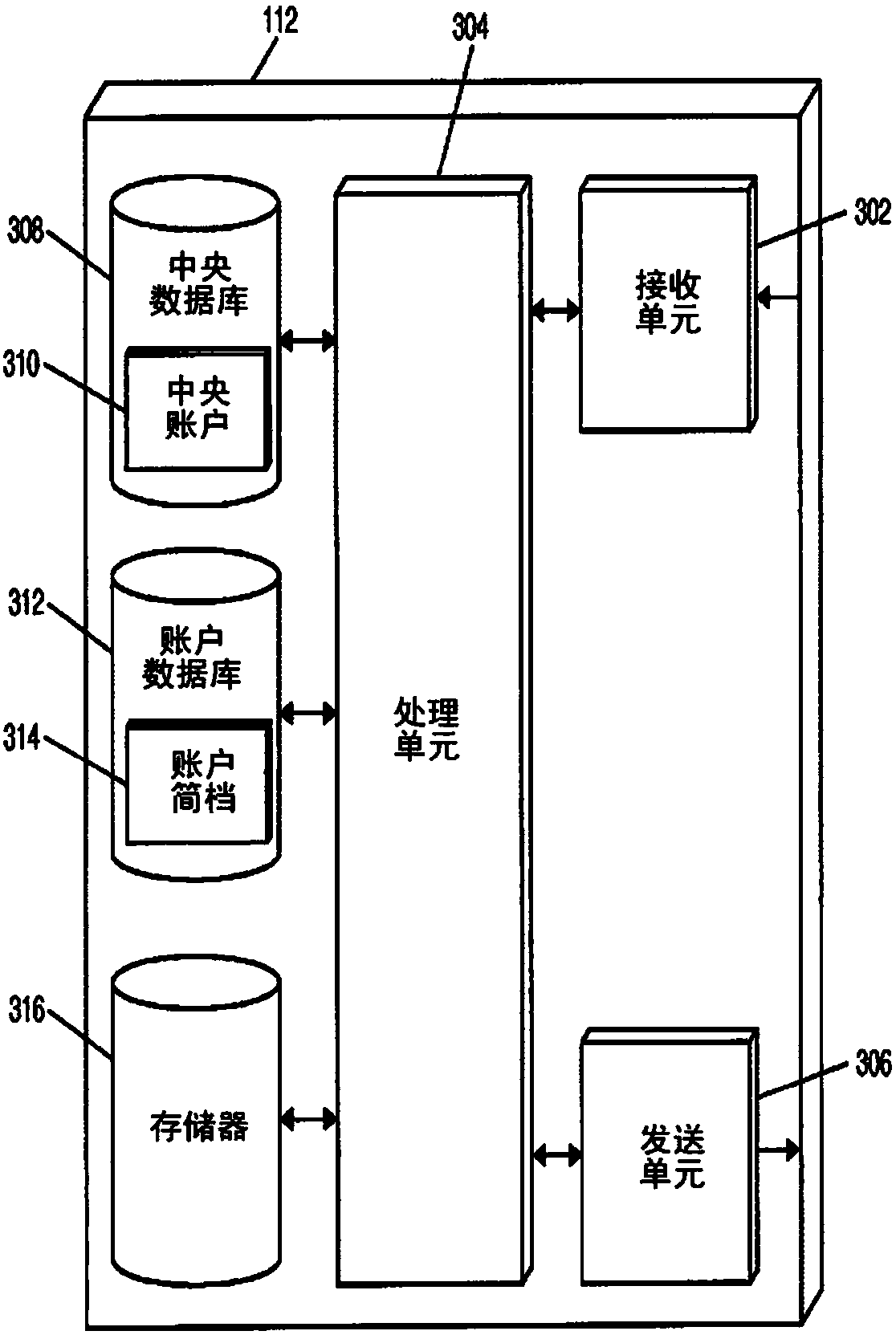

Method and system for linkage of blockchain-based assets to fiat currency accounts

A method for managing fractional reserves of blockchain currency includes: storing, in a first central account, a fiat amount associated with a fiat currency; storing, in a second central account, a blockchain amount associated with a blockchain currency; storing a plurality of account profiles, each profile including a fiat currency amount, blockchain currency amount, account identifier, and address; receiving a transaction message associated with a payment transaction, the message being formatted based on one or more standards and including a plurality of data elements, including a data element reserved for private use including a specific address and a transaction amount; identifying a specific account profile that includes the specific address included in the data element in the received transaction message; and updating the blockchain currency amount included in the identified specific account profile based on the transaction amount included in the data element in the received transaction message.

Owner:MASTERCARD INT INC

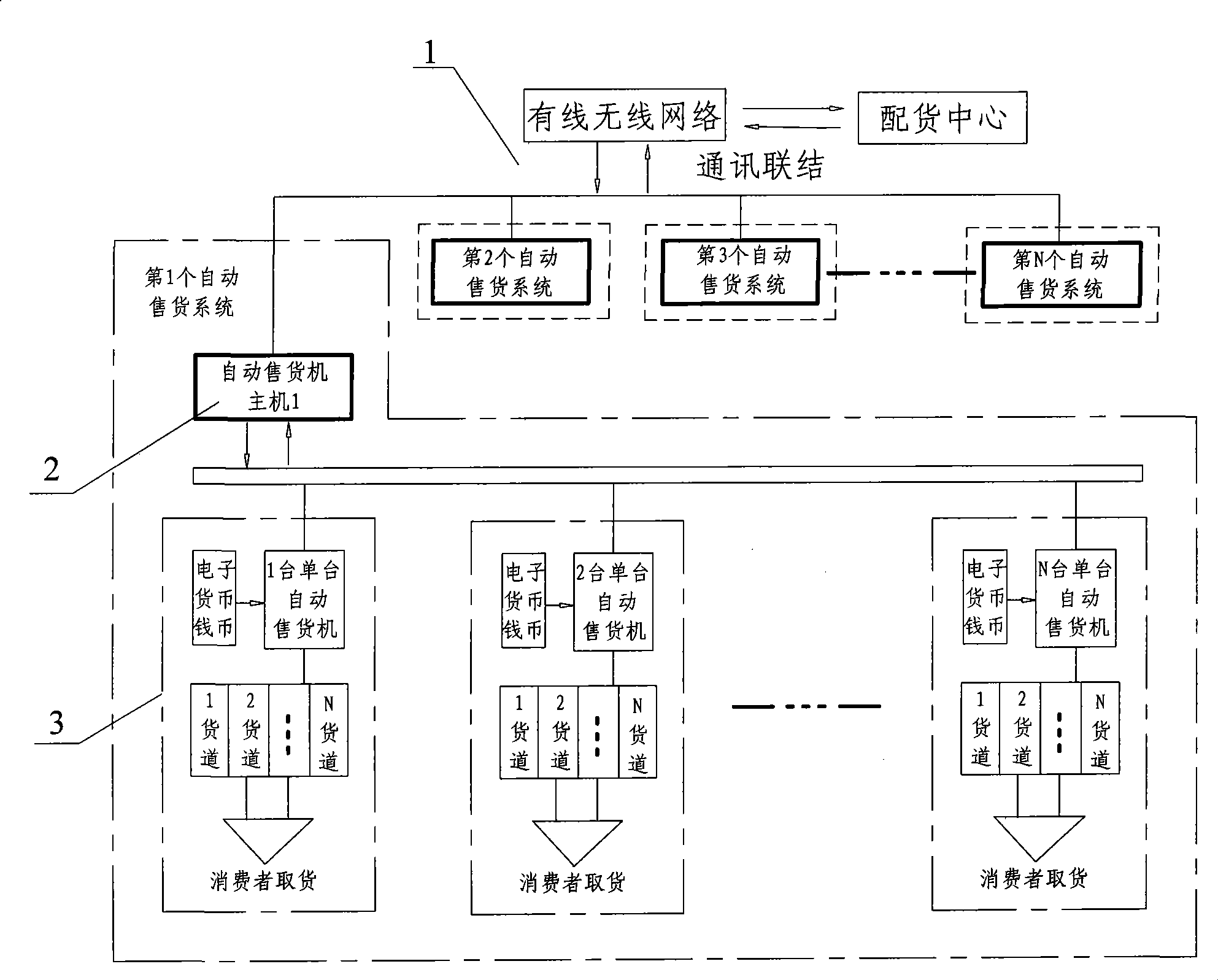

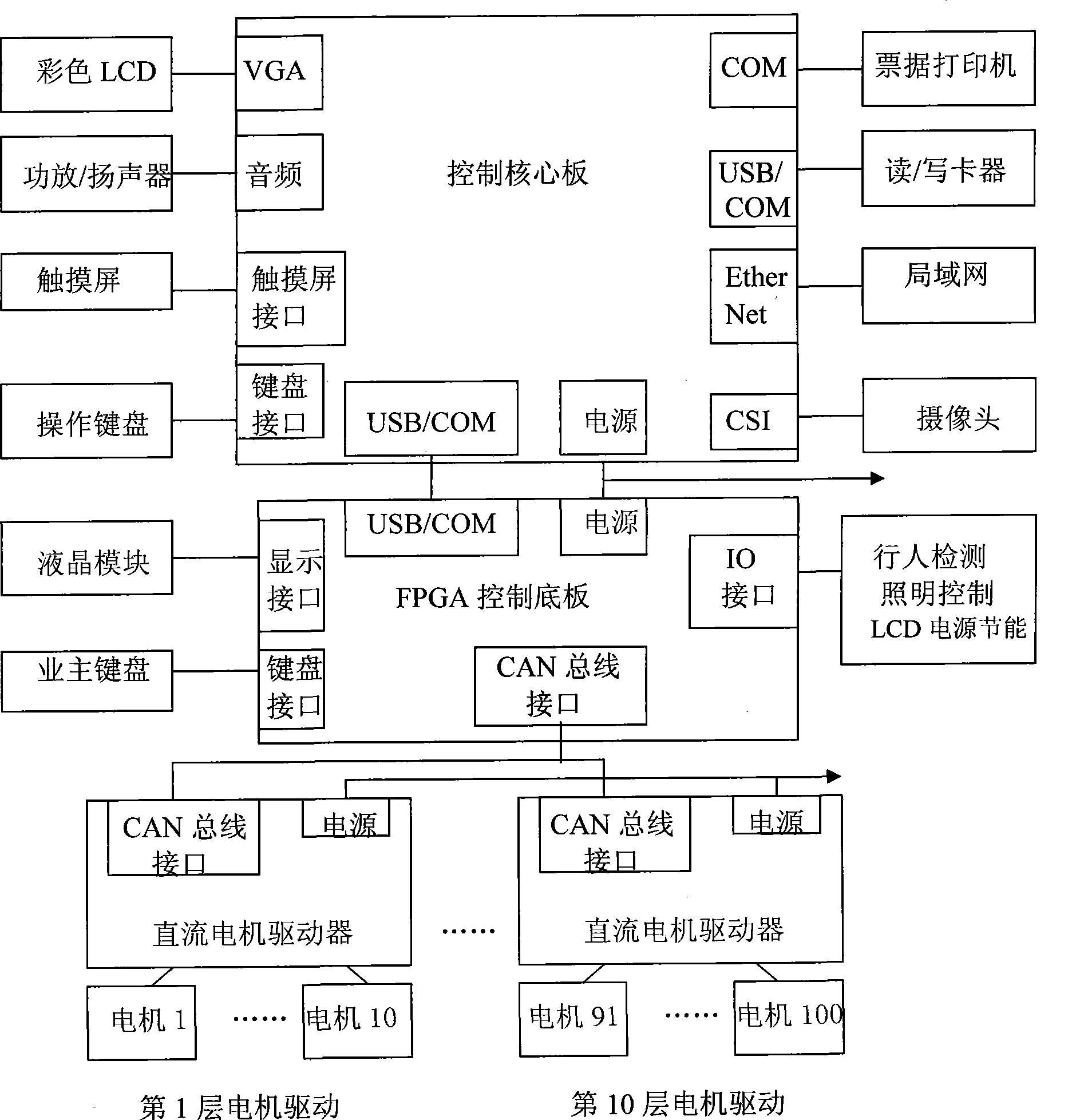

Automatic vending system for hotels

The invention provides an automatic vending system used in hotels. The automatic vending system comprises a vending machine which is provided with a human-machine communication interface as a selling and pick-up platform to construct a mainframe which is provided with a plurality of vending machines and has the management function for controlling operation, monitoring and storing information and form 1 to N purchasing local networks. The automatic vending system is arranged in the hotel; a convenient purchasing chain store network of an area is formed by a computer network; a production-direct selling information transferring chain constructed by consumption information of the local networks is used for counting the intraday goods shortage condition and arranging to supply the variety and the quantity of the goods out of stock in each set of vending machine; after the consumer receives an electronic currency card, the consumer chooses the goods by a touch screen; the mainframe checks the currency amount by a card reader to send an output command to a motor control board; the motor control board records and reduces the quantity of the goods and controls a corresponding goods channel to output the goods; and at the same time, the mainframe uploads a trade record at real time to instruct printing a bill. The automatic vending system has the advantage of integrating the computer network purchasing technology, the electronic consumption system technology and the vending machine technology as a whole.

Owner:FOSHAN CORNUCOPIA DIGITAL ELECTRIC NANHAI

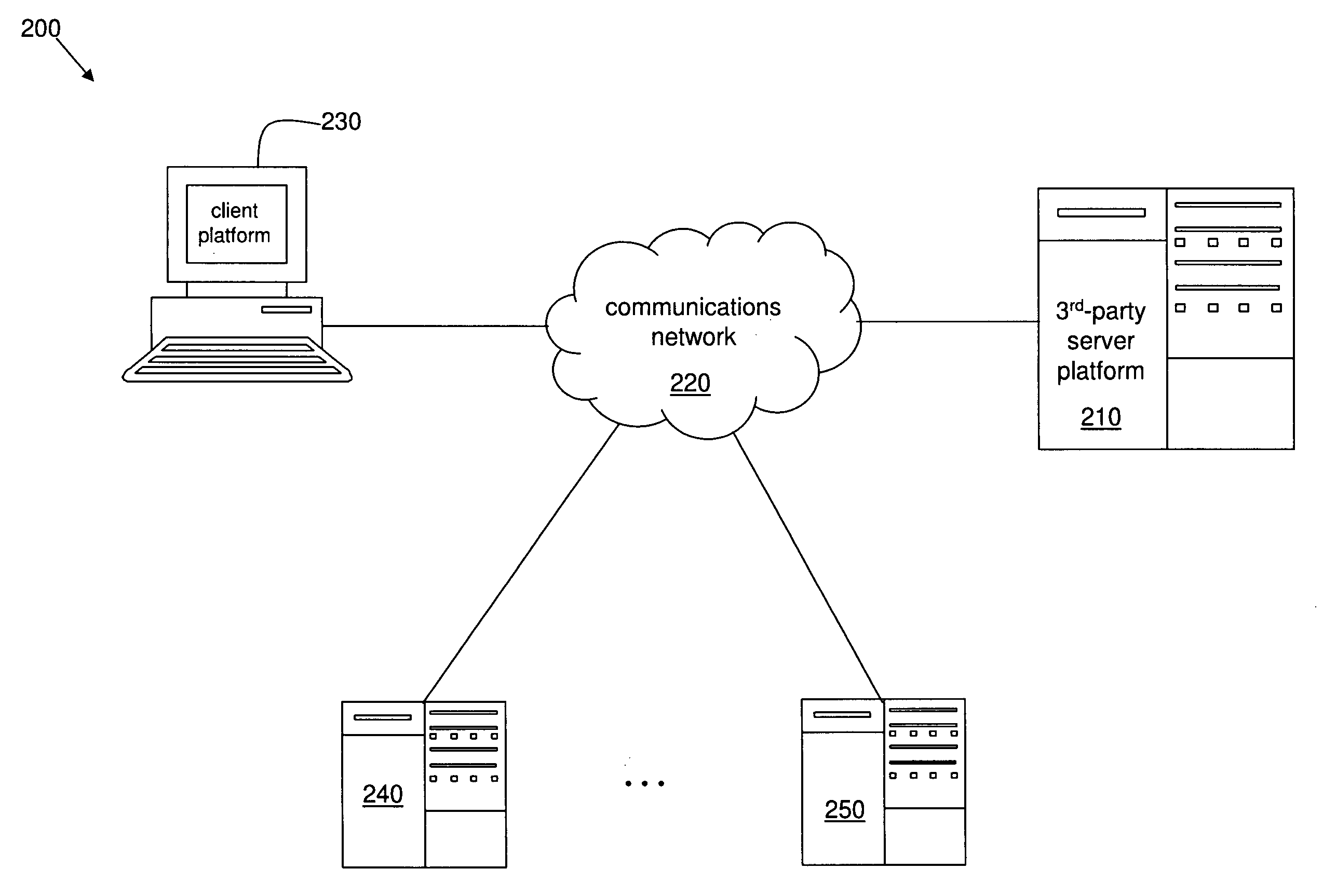

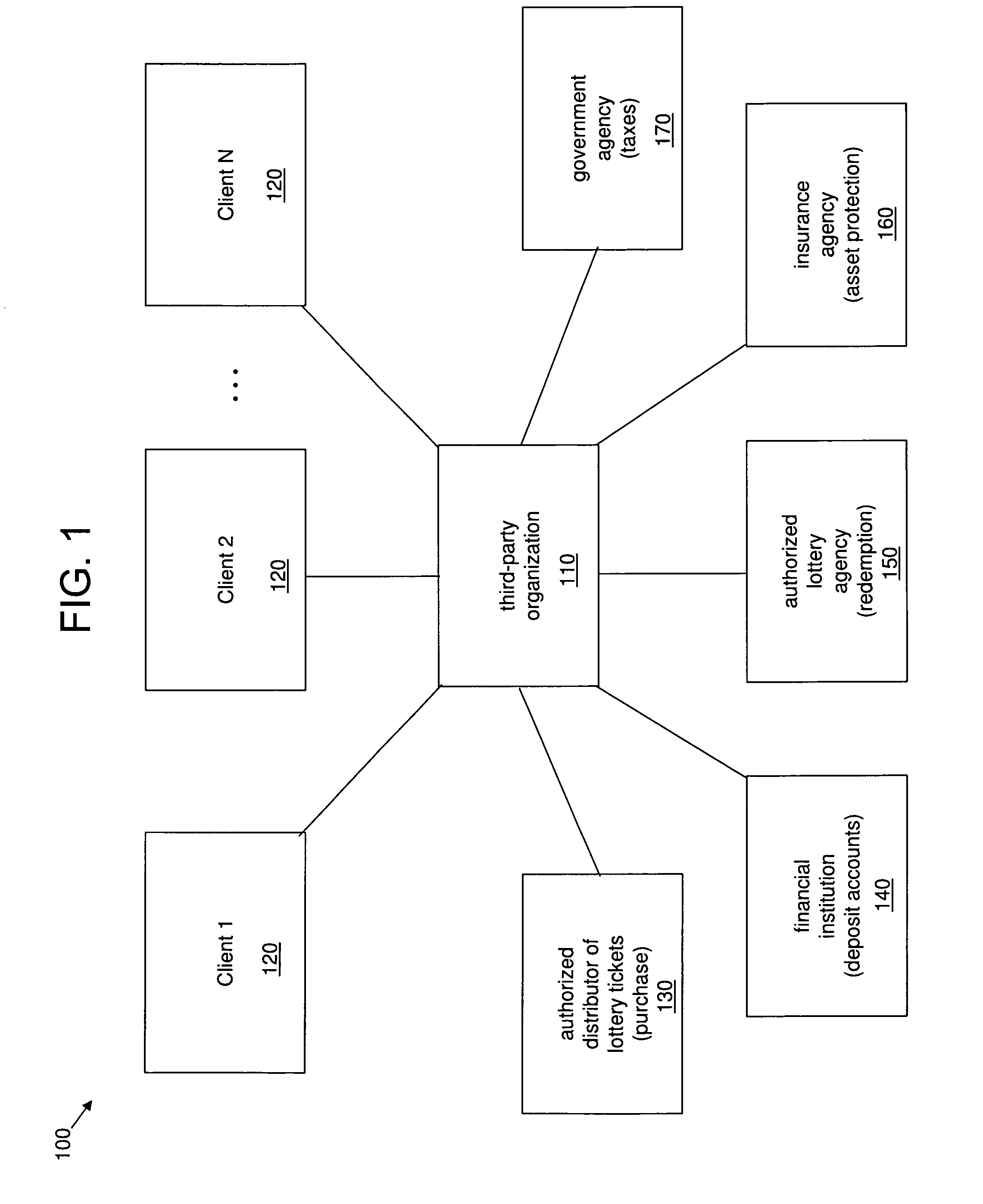

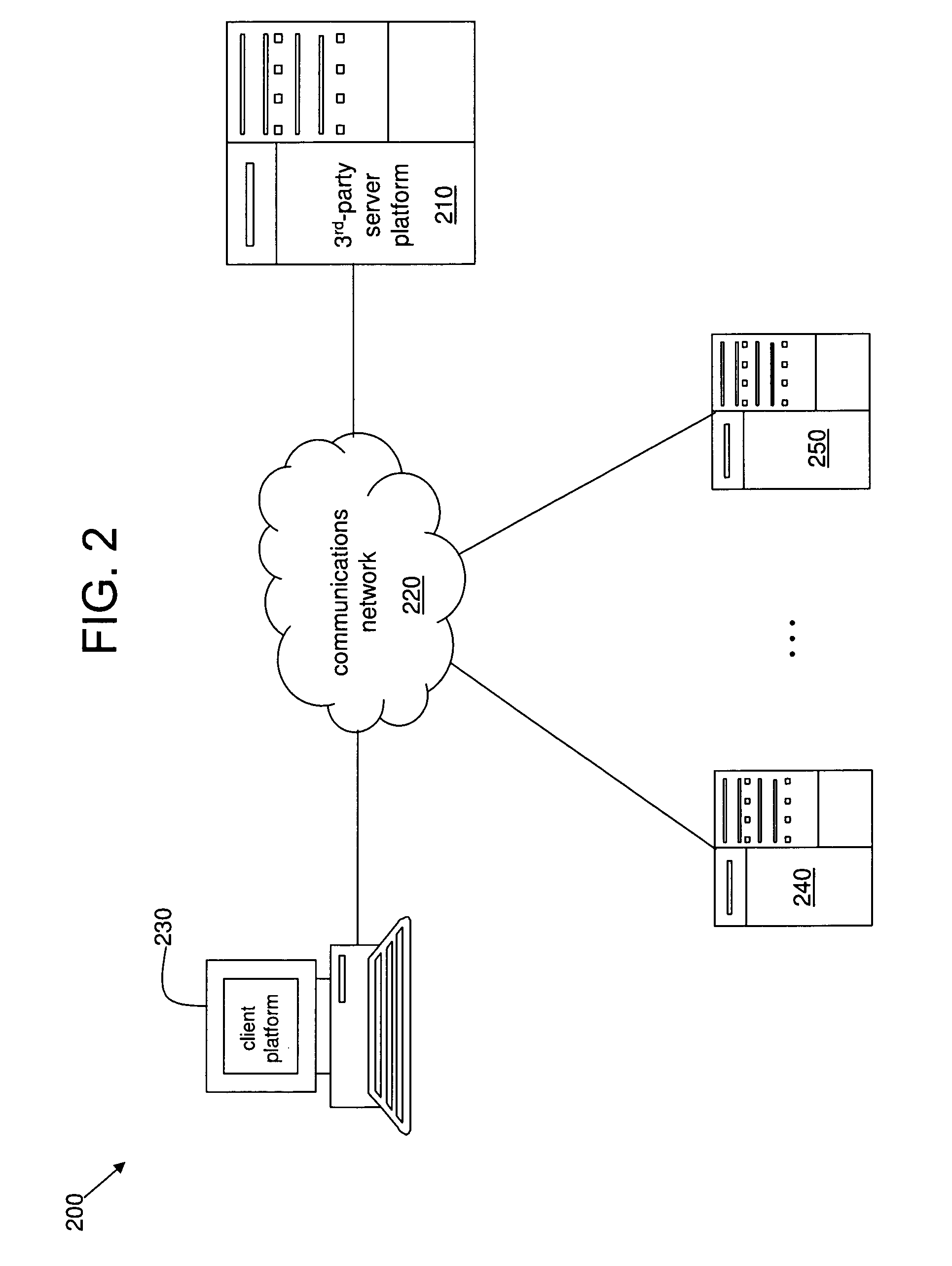

System and method for anonymously servicing lottery players

ActiveUS8219497B2Facilitate methodImprove identityDiscounts/incentivesPayment architectureThird partyClient-side

A system and method for servicing at least one lottery player while protecting an identity of the at least one lottery player. The system includes a server platform of a third party organization that facilitates the method. The method includes receiving a client request at the server platform via a communications network. The method further includes the third party organization obtaining at least one lottery ticket in response to the client request, and securely holding the at least one lottery ticket for the at least one lottery player specified in the client request. The method also includes the third party organization determining a status of the at least one lottery ticket via the server platform and the communications network. The method further includes the third party organization transforming the at least one lottery ticket into a monetary amount if a status of the at least one lottery ticket is or changes to a winning status. The method also includes the third party organization securely transferring at least a first portion of the monetary amount to at least one account or trust.

Owner:CRUCS HLDG

System and method for processing transactions

InactiveUS20130204784A1Harder to foolReduce riskFinancePayment architecturePaymentTransaction processing system

An electronic transaction processing system comprising an inbound payment processing module, an outbound payment processing module, an authorization module, and a data store containing financial account data relating to an entity. The authorization module is arranged to authorize processing of outbound payments by the outbound payment processing module, the financial account data defines a currency amount corresponding to working capital of the entity, inbound payments processed by the inbound payment processing module are added to said currency amount, and authorized outbound payments processed by the outbound payment processing module are removed from said currency amount.

Owner:VOICE COMMERCE GROUP TECH

Methods and apparatus for facilitating a currency exchange transaction

Methods and apparatus for prompting a user to enter currency of a first country including at least one of notes and coins into a foreign exchange kiosk; applying one or more currency exchange rates to a total of the entered currency to compute a converted currency amount of a second country; and conducting a money transfer with a third party based on the converted currency amount.

Owner:PAE HEE CHEOL

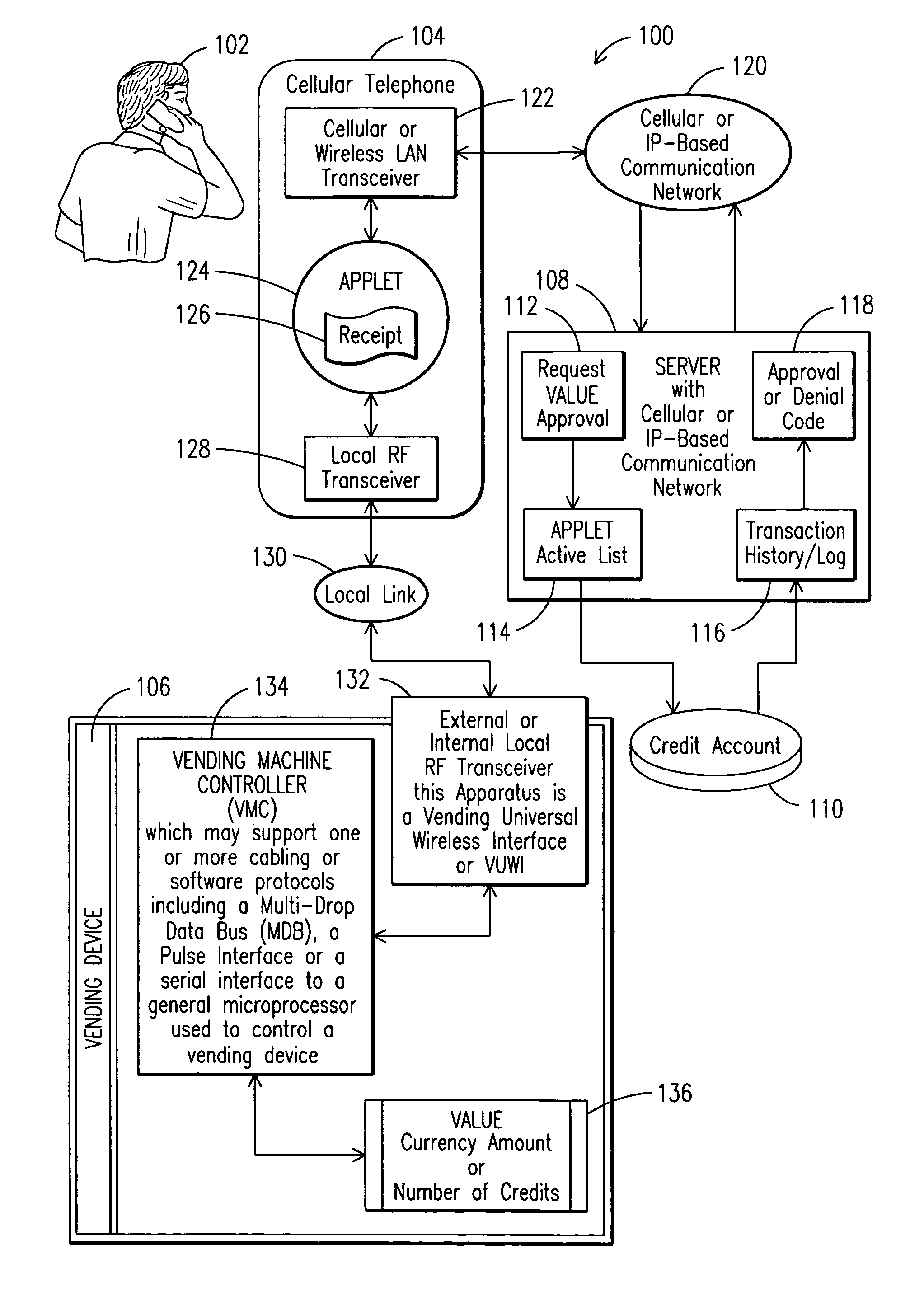

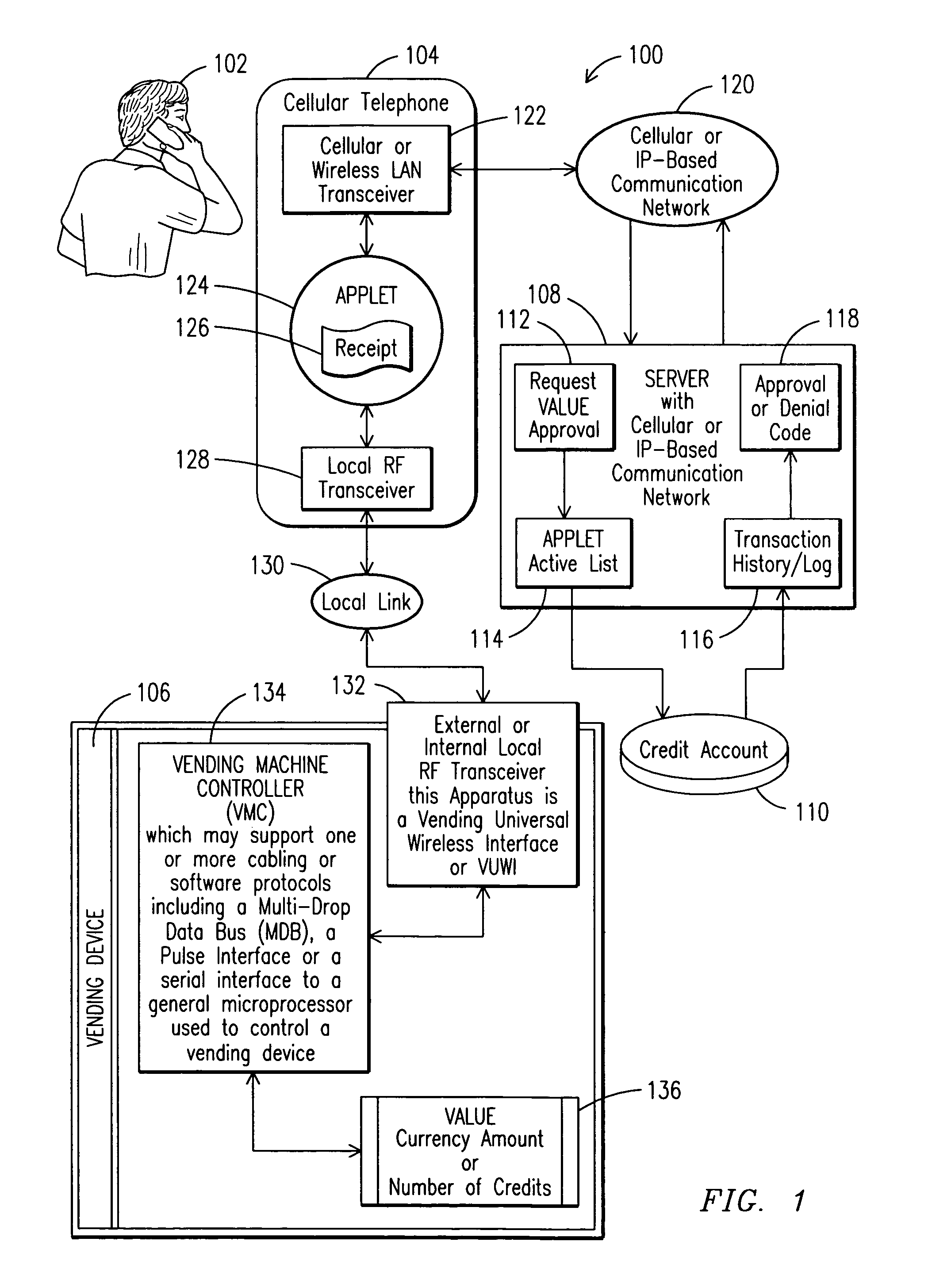

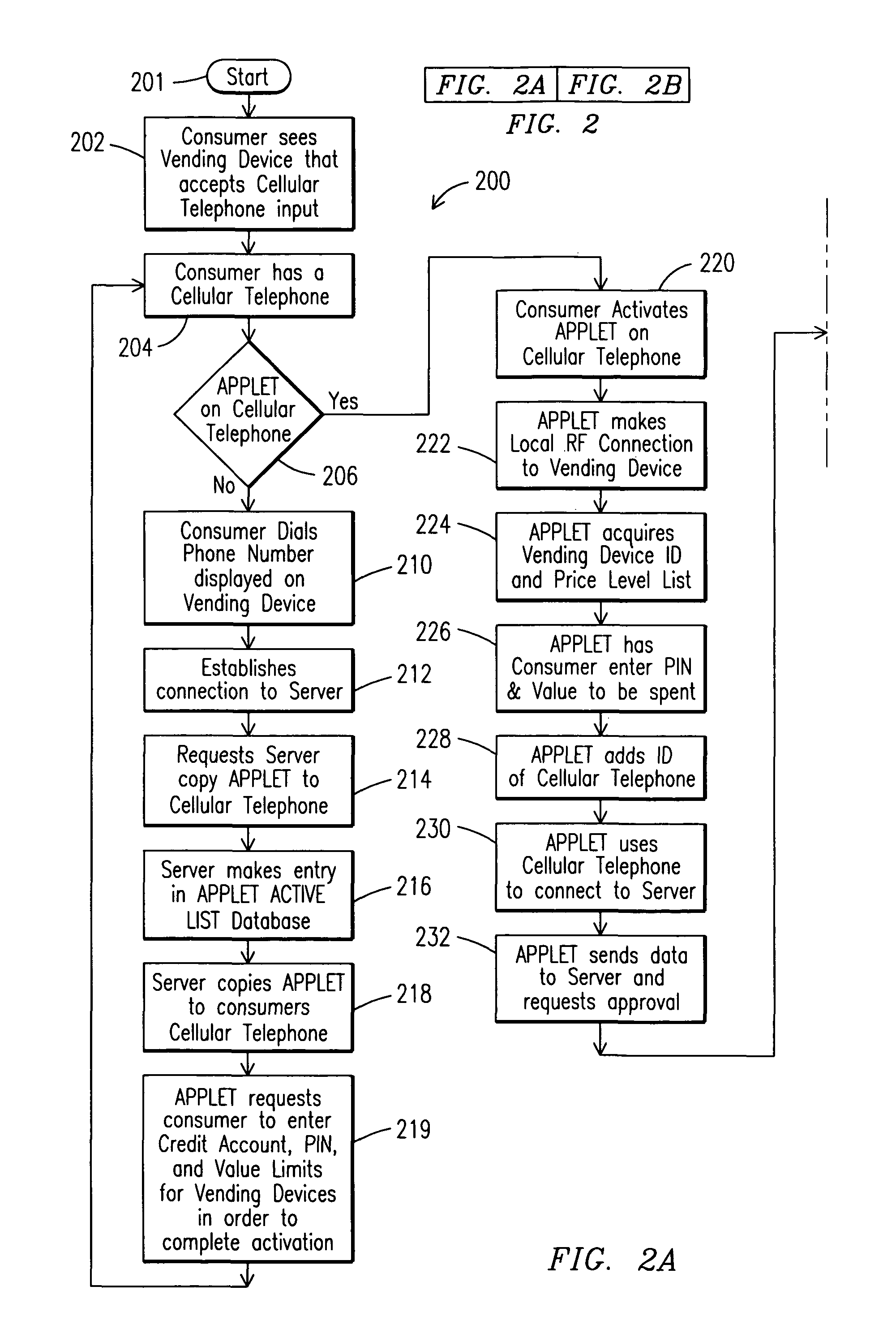

Method of establishing credit on a vending device

A method and system is provided for establishing credit on an automatic vending machine or vending device. A currency amount or a number of credits is established on a vending device in order to obtain a product, service or access time from a vending device using a cellular telephone, or other personal wireless communication device. The personal wireless communication device activates an applet, which may be downloaded at the site, to establish a link with a vending machine universal wireless interface coupled to the vending machine device controller and also establishes a link with a remote server for authorizing credit for a vending transaction, which allows the vending transaction to take place.

Owner:COIN FREE

System and method for payment processing using crypto currencies

A payment processor receives currency information and identification information. The currency information comprising a payer fiat-currency and a payee fiat-currency and the identification information comprises information verifying the identify of a payer and a payee. The payment processor utilizes the currency information and the identification information to determine a transaction restriction level and verifies that the identification information meets the threshold for the transaction restriction level. The payment processor receives payment in the payer fiat-currency and initiates a transaction to convert the payer fiat-currency amount into a crypto-currency amount. The payment processor converts the crypto-currency amount into the payee fiat-currency. The payment processor initiates a transfer of the payee fiat-currency amount to the payee.

Owner:VEEM

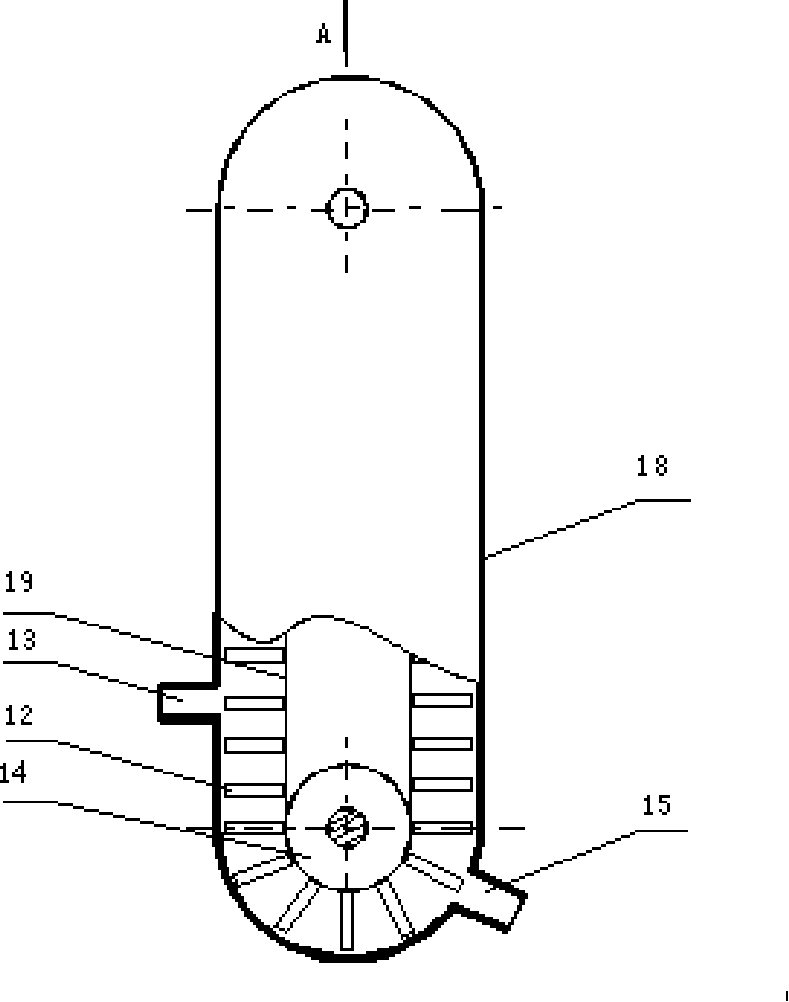

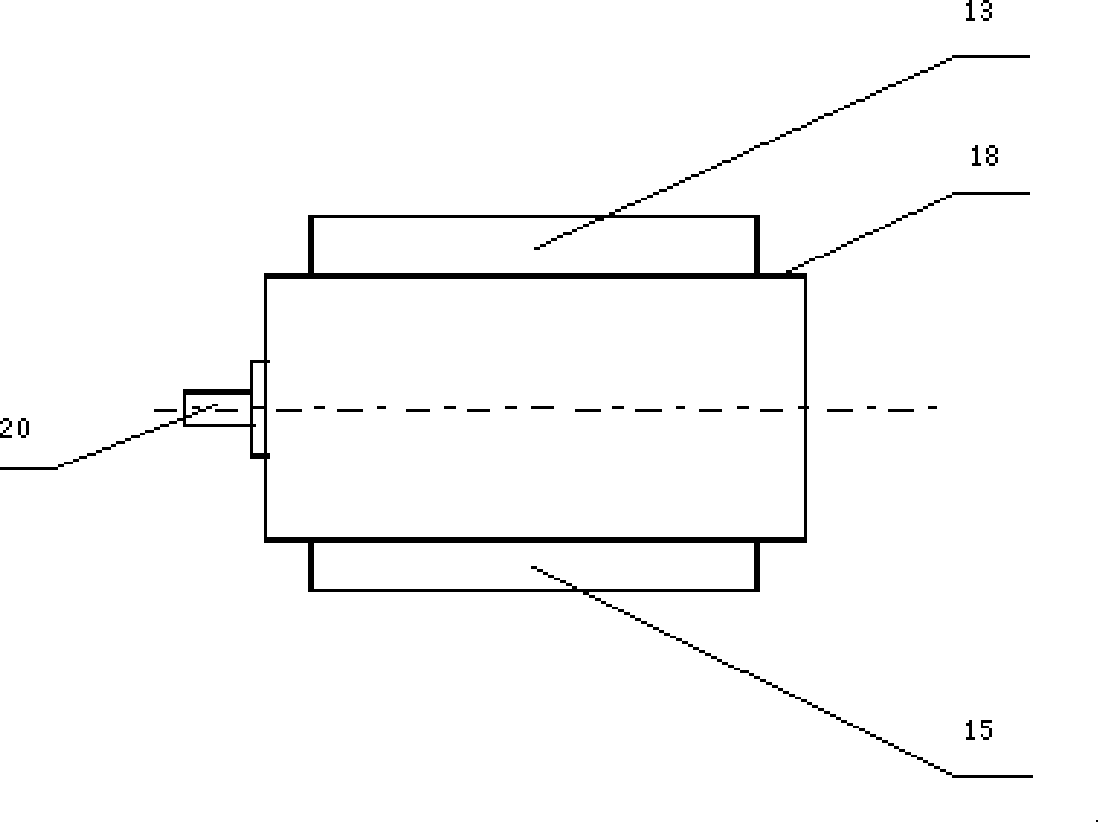

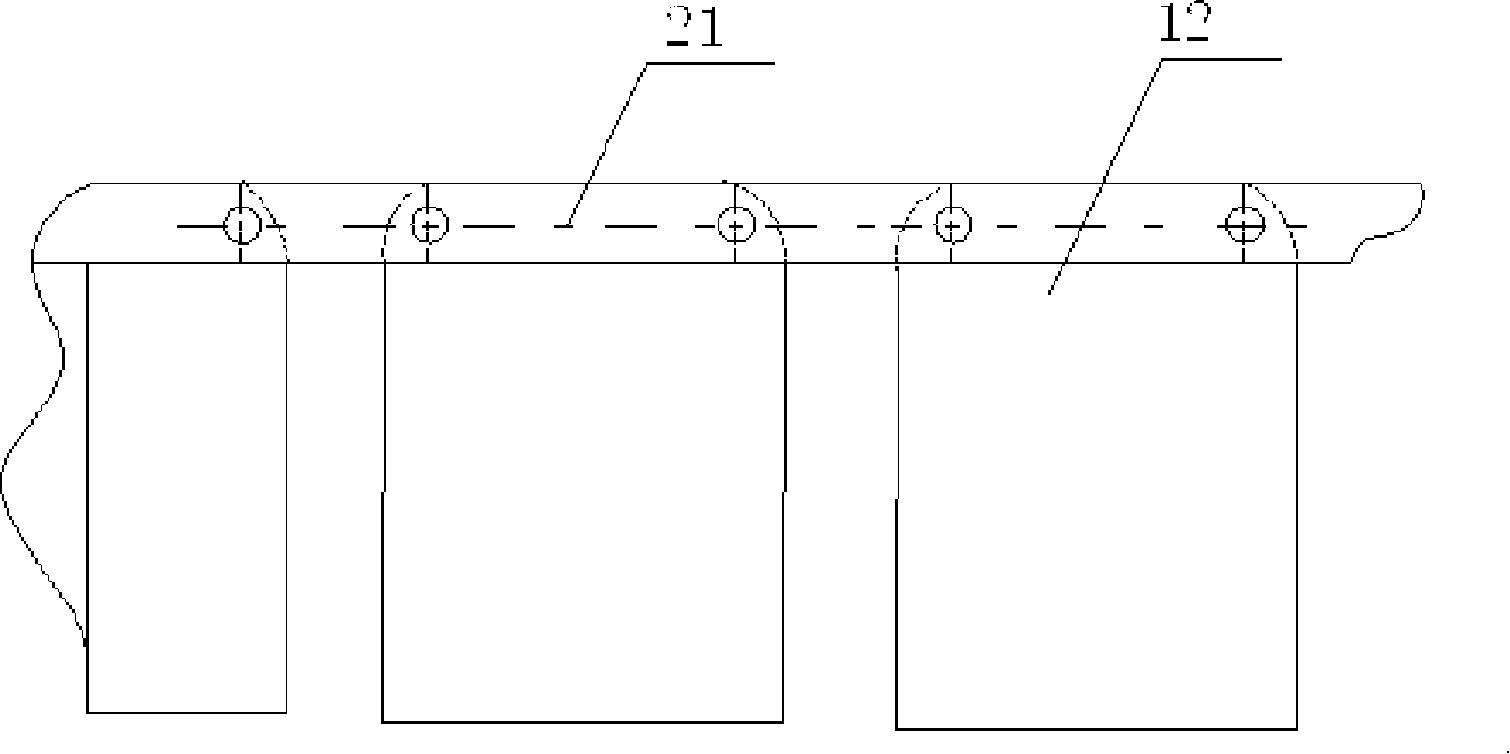

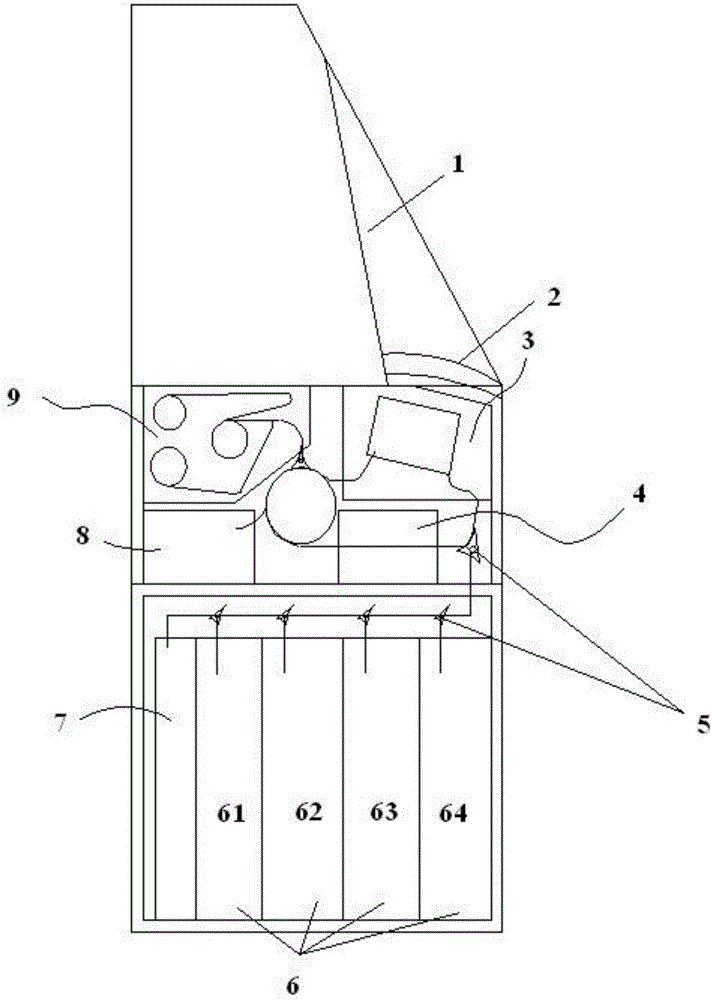

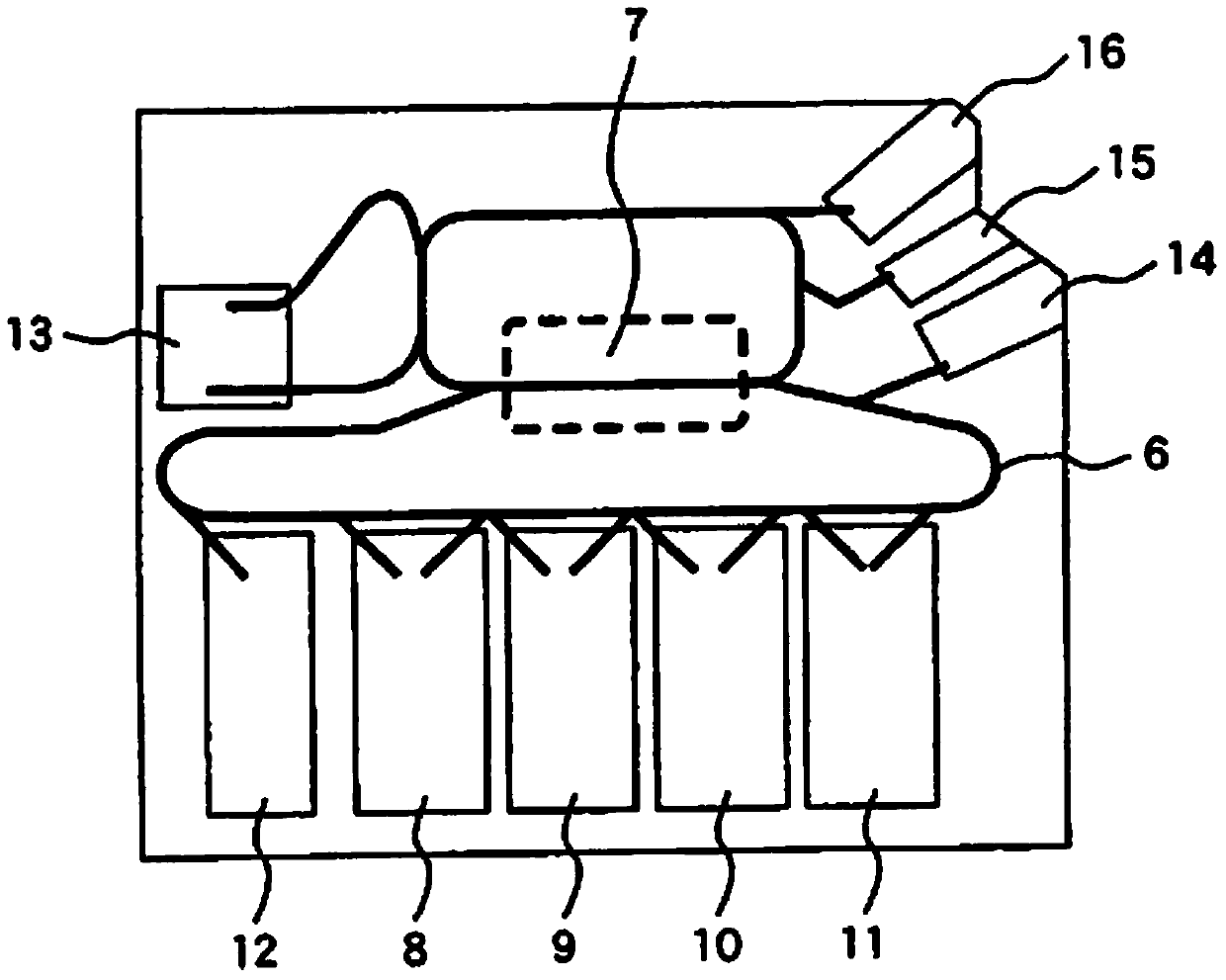

Method and device of quick-speed mechanism for object to be paid

InactiveCN101178827AImprove work efficiencyComplete banking machinesCoin-freed apparatus detailsEngineeringMechanical engineering

The invention relates to a delivering mechanism which can be used on an automatic teller machine, an automatic card selling machine, an automatic goods selling machine and an automatic ticket selling machine. The invention solves the problem that the existing automatic teller machine, automatic card selling machine, automatic goods selling machine and automatic ticket selling machine take long time to deliver and are slow in transaction. A delivering mechanism is arranged inside a box with an inlet and an outlet; the delivering mechanism comprises a plurality of storage units which are arranged together in parallel and are movable; the currency is identified and put into the storage unit of the delivering mechanism according to the amount; similarly, a certain amount of cards, tickets and goods are put into the delivering mechanism and the amounts are recorded in each storage unit; the currency amount planned to be delivered is entered into the computer; similarly, the amounts of cards, tickets and goods planned to be delivered are entered into the computer which controls the mechanism; the delivering mechanism is started by the computer and operates according to the orders of the computer; when the storage unit with the same amount of objects to be delivered corresponds to the outlet of the box, the objects to be delivered are discharged through the outlet.

Owner:BEIJING RINRONG TECH

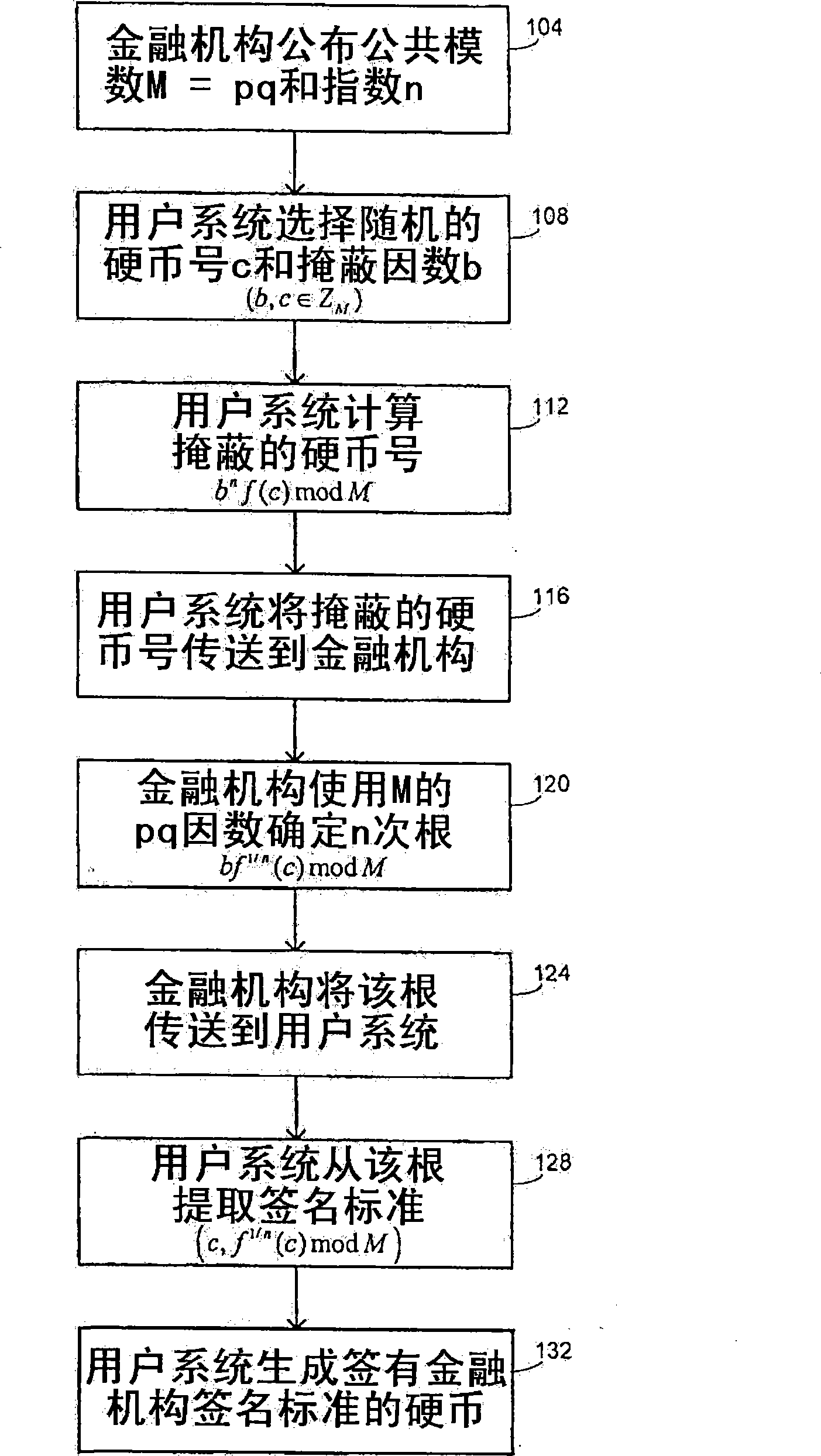

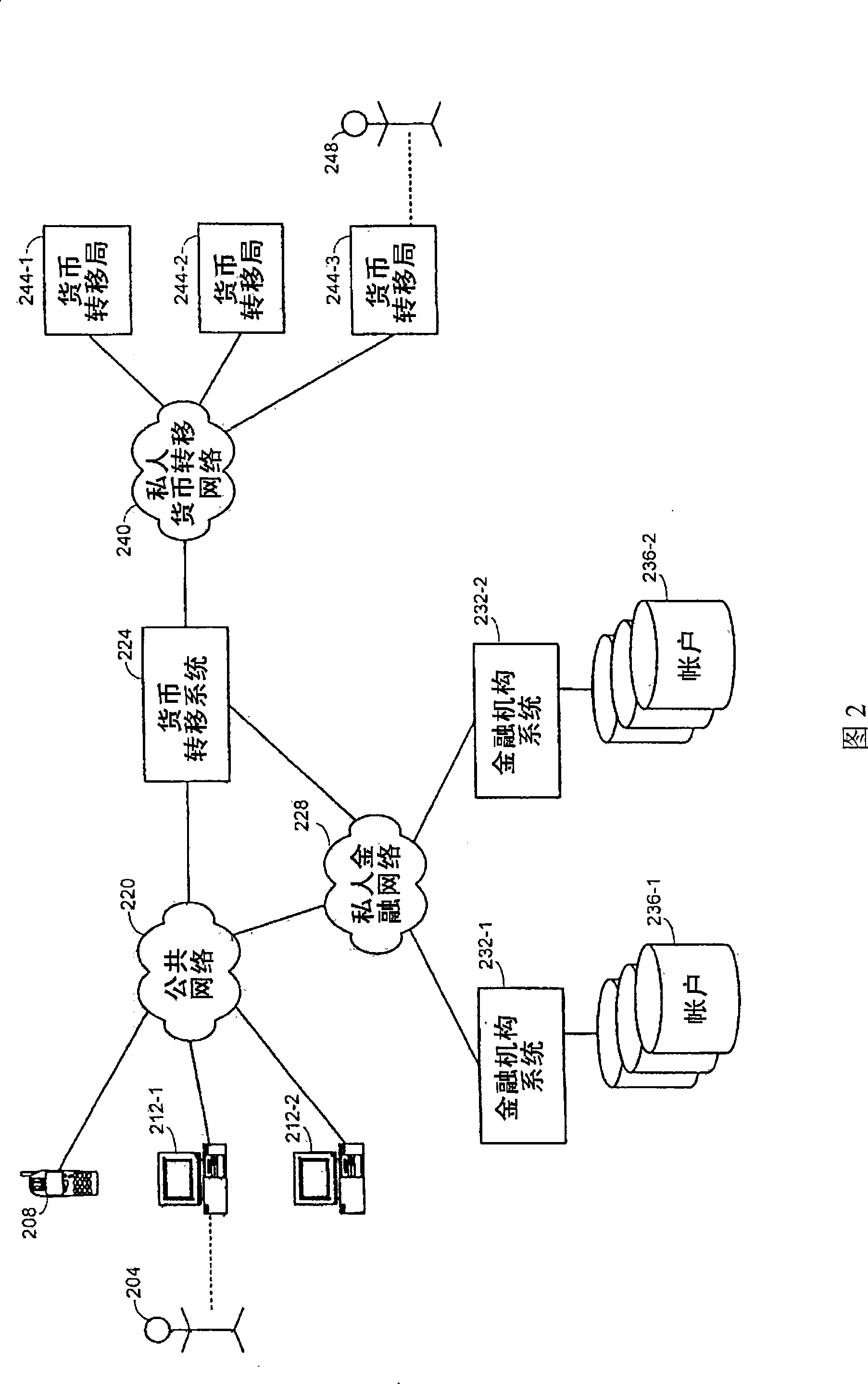

Money transfers using digital cash

Methods and systems are described for transferring funds from a sender to a recipient. Source funds are received from a sender. An amount of recipient funds is determined from a value of the source funds. A transfer identifier associated with the recipient funds is generated and provided to the sender. The transfer identifier is received from the recipient, prompting a transfer in control of the recipient funds to the recipient. At least one of the source funds and the recipient funds are in the form of one or more electronic tokens. Each such electronic token has a currency amount and a digital signature identifying a financial institution that backs the electronic token for the currency amount.

Owner:FIRST DATA

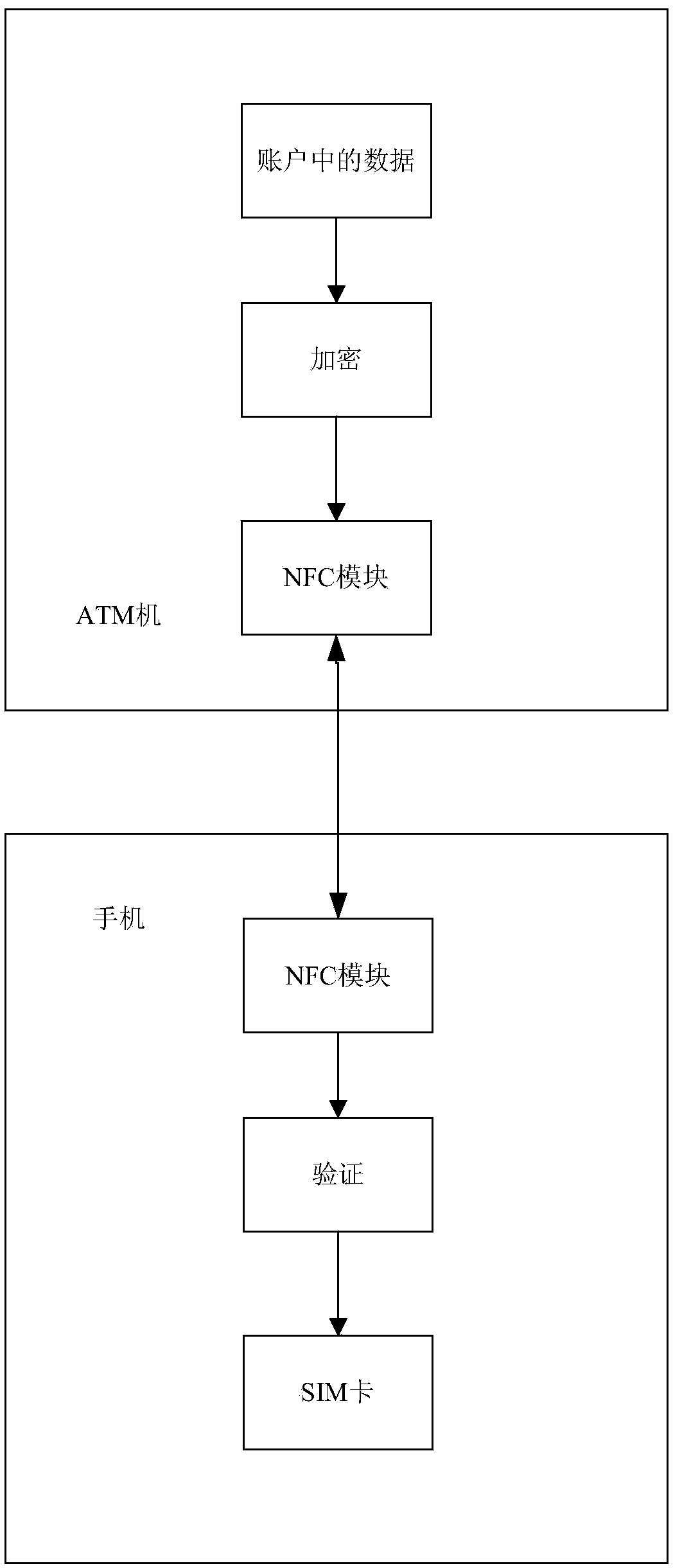

Electronic currency circulating method

InactiveCN103729794ADeal realTransaction is reliableComplete banking machinesFinancePayment transactionNetwork packet

The invention discloses an electronic currency circulating method. A mobile phone is used as a means of transaction, and an SIM card of the mobile phone is used as a carrier of electronic currency. Encrypted data packets containing currency amount data are transmitted through the NFC so as to perform the collection and payment transaction or the deposit and withdrawal transaction. The electronic currency circulating method can reduce or replace use of paper money and be more friendly to the environment. Based on encryption and verification of mobile software, it is ensured that the transaction is true and reliable. By means of the transaction manner, change is not needed, paper money detecting is not needed, and a user does not need to worry about the safety problem in carrying a large amount of paper money.

Owner:SHENZHEN YIHUA COMP +2

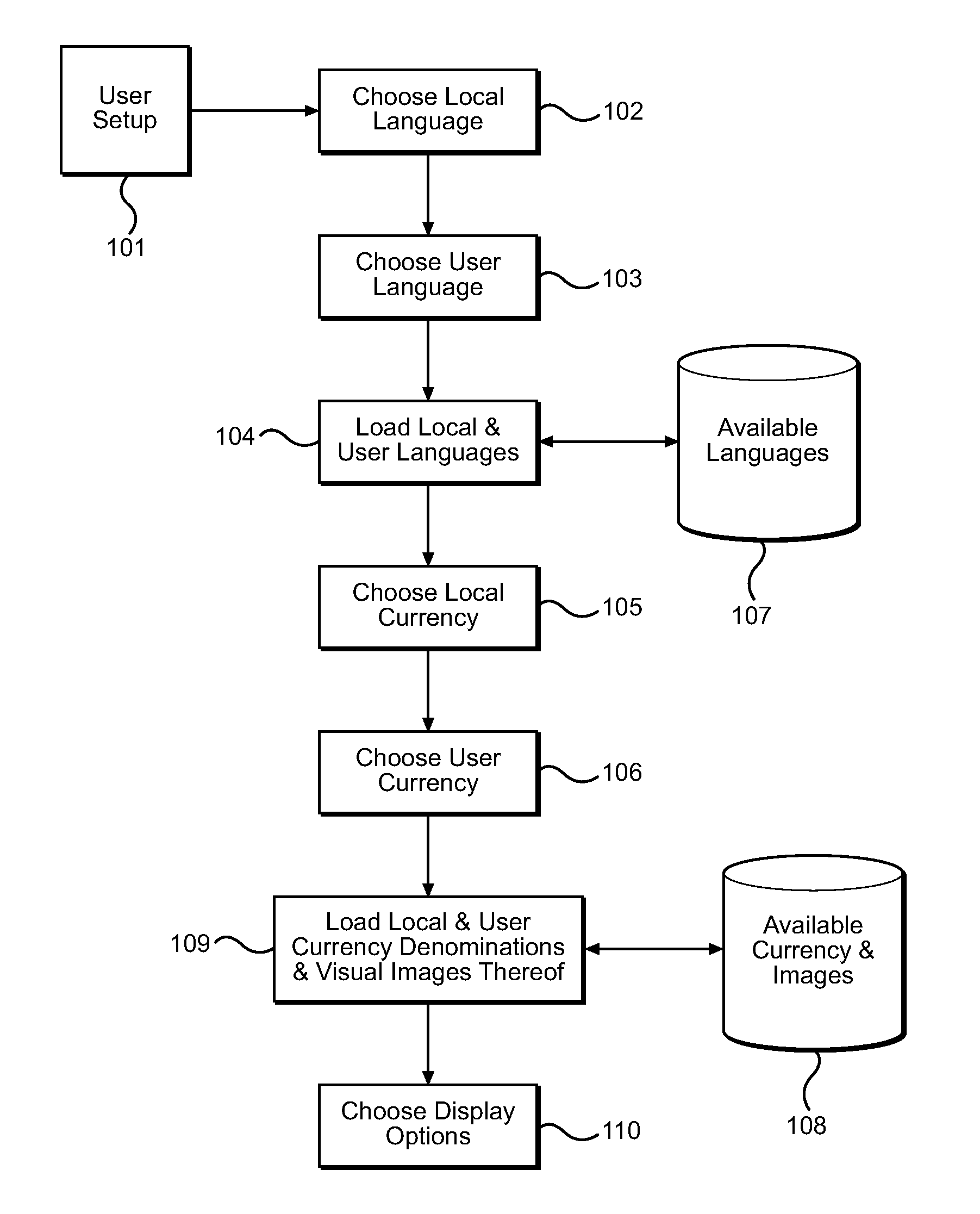

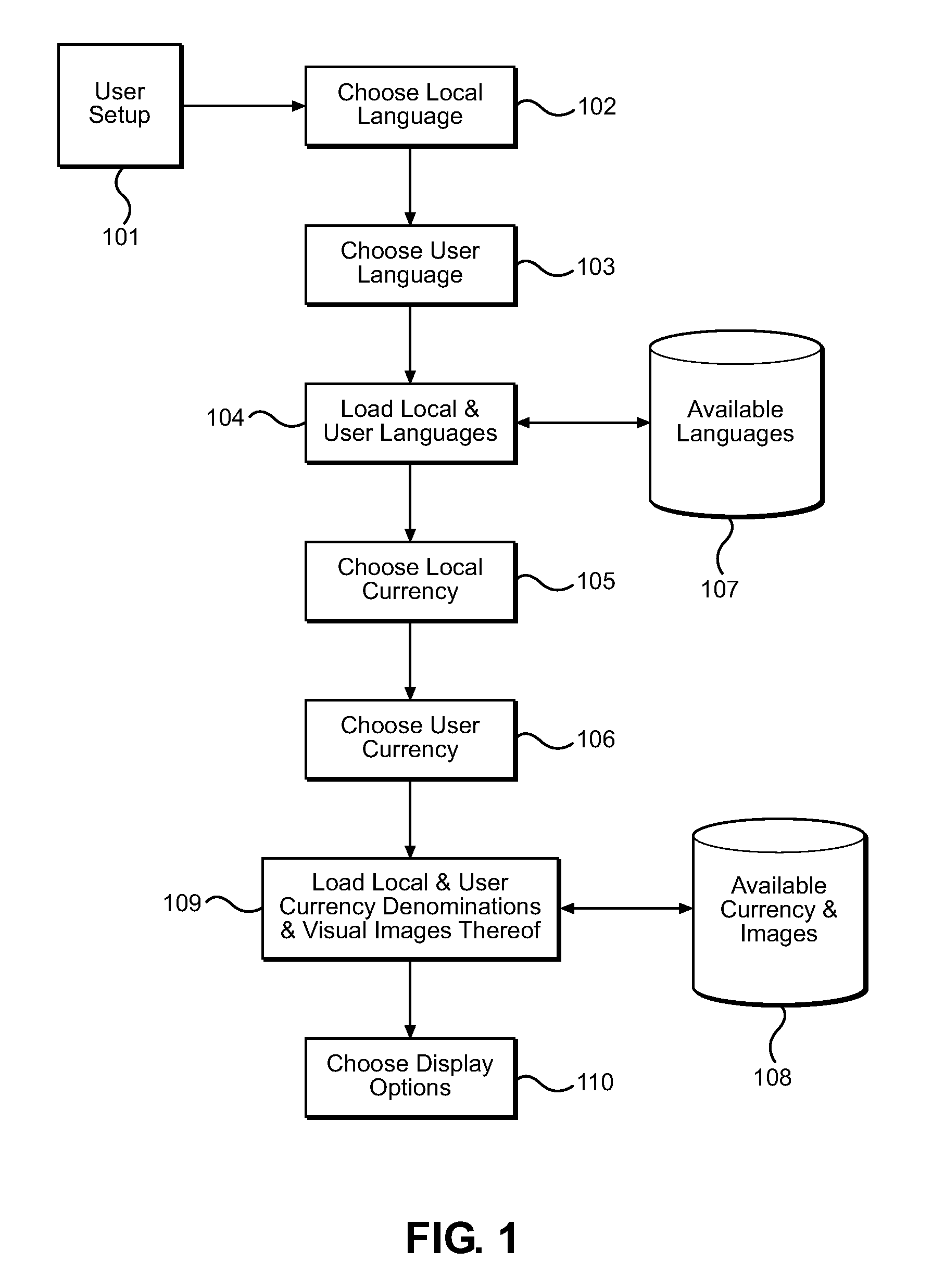

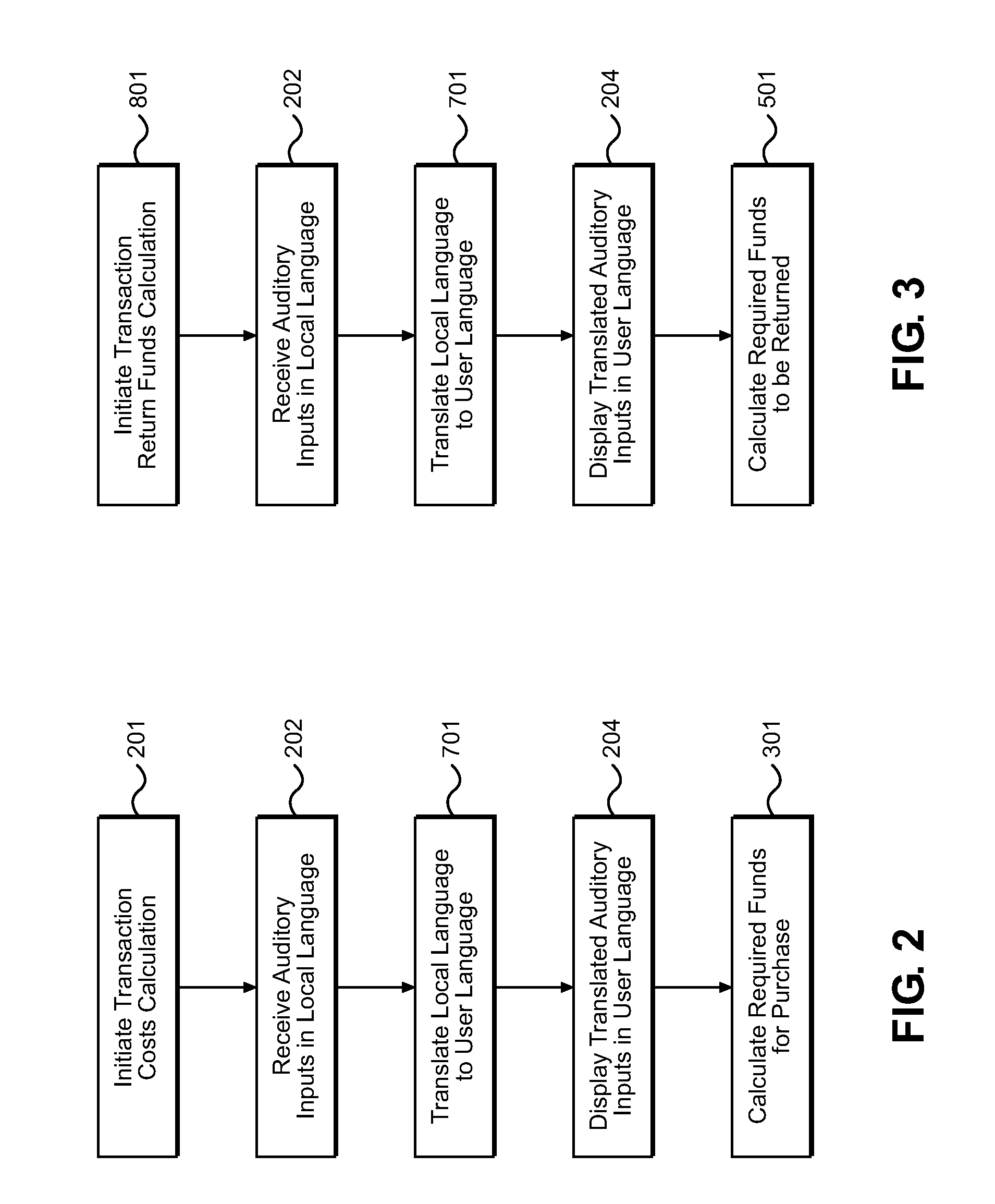

Foreign Language and Currency Calculator and Method of Facilitating Transactions in a Foreign Currency at the Point of Sale

InactiveUS20140019273A1Convenient transactionReduce anxietyNatural language translationCurrency conversionDisplay deviceHand held devices

A method of facilitating transactions at the point of sale using foreign currency is provided. The method includes use of a handheld electronic device to receive voice input to discern the costs and the anticipated change to be returned from a clerk during a transaction for goods. A handheld device is utilized to receive voice input from the clerk in a foreign language, calculates the currency amount required to be paid by the user, and displays the required currency on its display screen, both in written words and in visual terms using dominations of the local currency. Voice inputs are then received from the user to determine the amount of currency given to the clerk, whereafter the amount of change anticipated from the transaction is visualized on the display for the user. The method facilities transparent transactions in foreign countries and helps teach foreign language skills in the process.

Owner:COMMISSION OF PATENTS

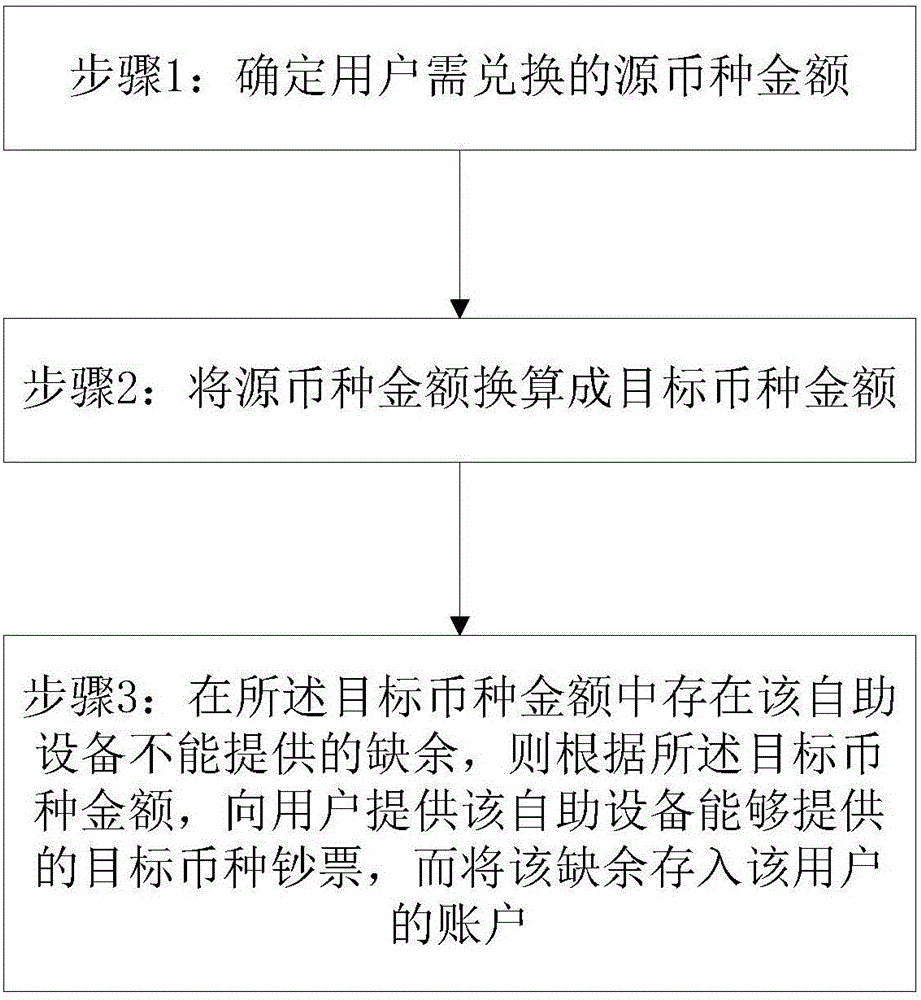

Method and device for running bank note currency exchange self-service equipment

InactiveCN105741440AReduce denomination typesReduce hardware costsComplete banking machinesUser needsOperational costs

The invention relates to the field of bank note self-service transaction equipment and discloses a method and device for running bank note currency exchange self-service equipment. The method and device are mainly used for controlling the bank note currency exchange self-service equipment to conduct bank note currency self-service exchange, and aim at solving the problem that through existing bank note currency exchange self-service equipment, bank notes with multiple denominations need to be deposited, and consequently hardware cost and running cost are high. The method for running the bank note currency exchange self-service equipment comprises the steps of determining a source currency amount which a user needs to exchange; converting the source currency amount into a target currency amount; providing target currency bank notes which can be provided by the self-service equipment for the user according to the target currency amount if a surplus which cannot be provided by the self-service equipment exists in the target currency amount, and depositing the surplus into the account of the user.

Owner:SHENZHEN YIHUA COMP +2

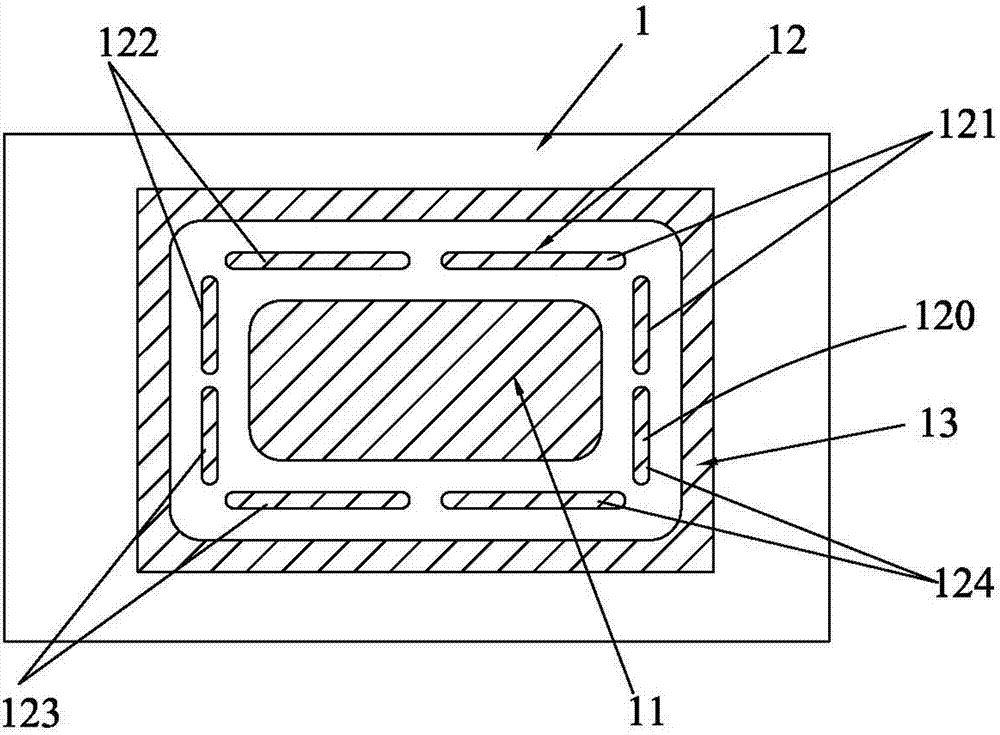

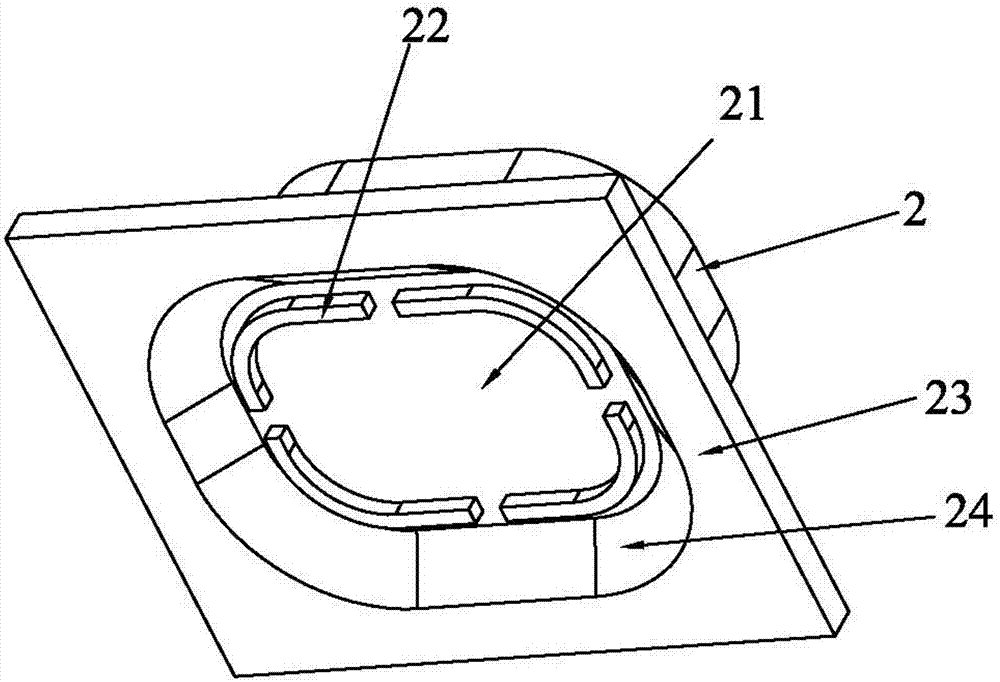

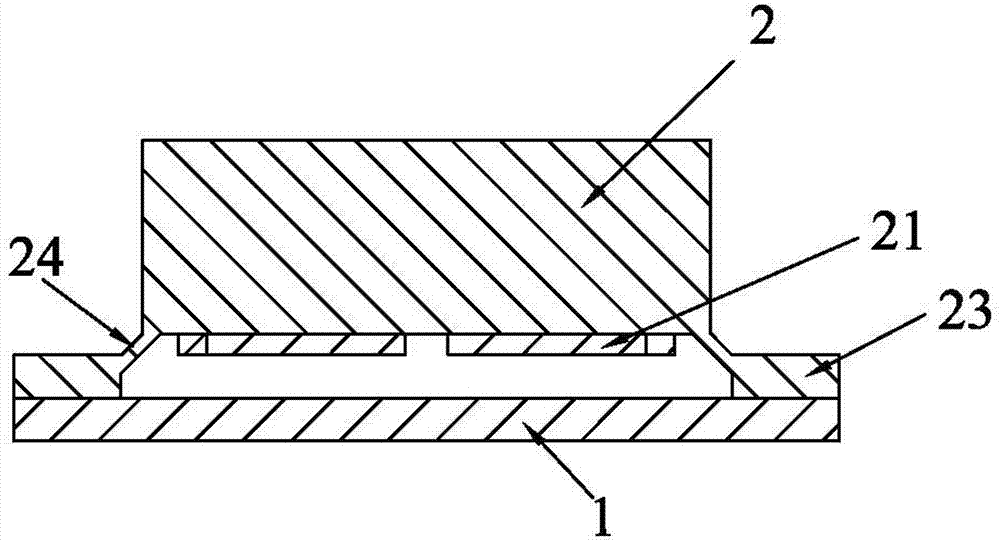

Tamper switch and financial machine

The invention discloses a tamper switch and a financial machine, and aims to provide the tamper switch which can prevent drilling attack and is safe. The tamper switch comprises a circuit board and a conductive adhesive, wherein an inner ring, an intermediate ring surrounding the inner ring and an outer ring surrounding the intermediate ring are arranged on the circuit board; the intermediate ring consists of a plurality of bonding pads which are separated and are paired; each pair of bonding pads form a group of signal switch; the conductive adhesive comprises an inner conductive layer pressed on the inner ring, an intermediate conductive layer pressed on the intermediate ring and an outer conductive layer pressed on the outer ring; and the intermediate conductive layer is separated into a plurality of intermediate conductive layers and are pressed on each group of the signal switch one by one. The temper switch can be used for financial industries, such as banks and securities, needing to encrypt data, and used for protecting sensitive information such as the account, the currency amount and password of clients.

Owner:深圳市九思泰达技术有限公司

Method, system and apparatus for the establishment of a virtual banking environment in a merchant venue while increasing the deposit-based assets of optionally interfaced traditional banking institutions subject to fractional-reserve banking

ActiveUS8494937B2Increasing deposit-based assetEliminating nuisanceComplete banking machinesFinanceEngineeringCurrency amount

A system incorporating method and associated apparatus for establishing virtual banking in a merchant venue or syndication of merchants for one or more consumers in a manner that increases the deposit-based assets of a related traditional banking institution by loading transactions of fractional currency amounts, preferably reflecting the acquisition of physical fractional currency, and more preferably coinage, and thereupon enabling inter-merchant (or syndicate) commercial transactions, including purchases and sales, in a manner that does not deplete deposit-based assets. Commercial transactions are at the direction of consumer(s) each with their own portable device linked to a merchant-hosted virtual account that maintains transaction details, histories and balances, and transmits data reflecting the same to the portable device(s) where it is recorded and displayed, upon demand. Also included are devices for executing commercial transactions with the portable device(s) and transmitting appropriate data to each bank and virtual account.

Owner:THEA FINANCIAL SERVICES

Money transfers using digital cash

Methods and systems are described for transferring funds from a sender to a recipient. Source funds are received from a sender. An amount of recipient funds is determined from a value of the source funds. A transfer identifier associated with the recipient funds is generated and provided to the sender. The transfer identifier is received from the recipient, prompting a transfer in control of the recipient funds to the recipient. At least one of the source funds and the recipient funds are in the form of one or more electronic tokens. Each such electronic token has a currency amount and a digital signature identifying a financial institution that backs the electronic token for the currency amount.

Owner:FIRST DATA

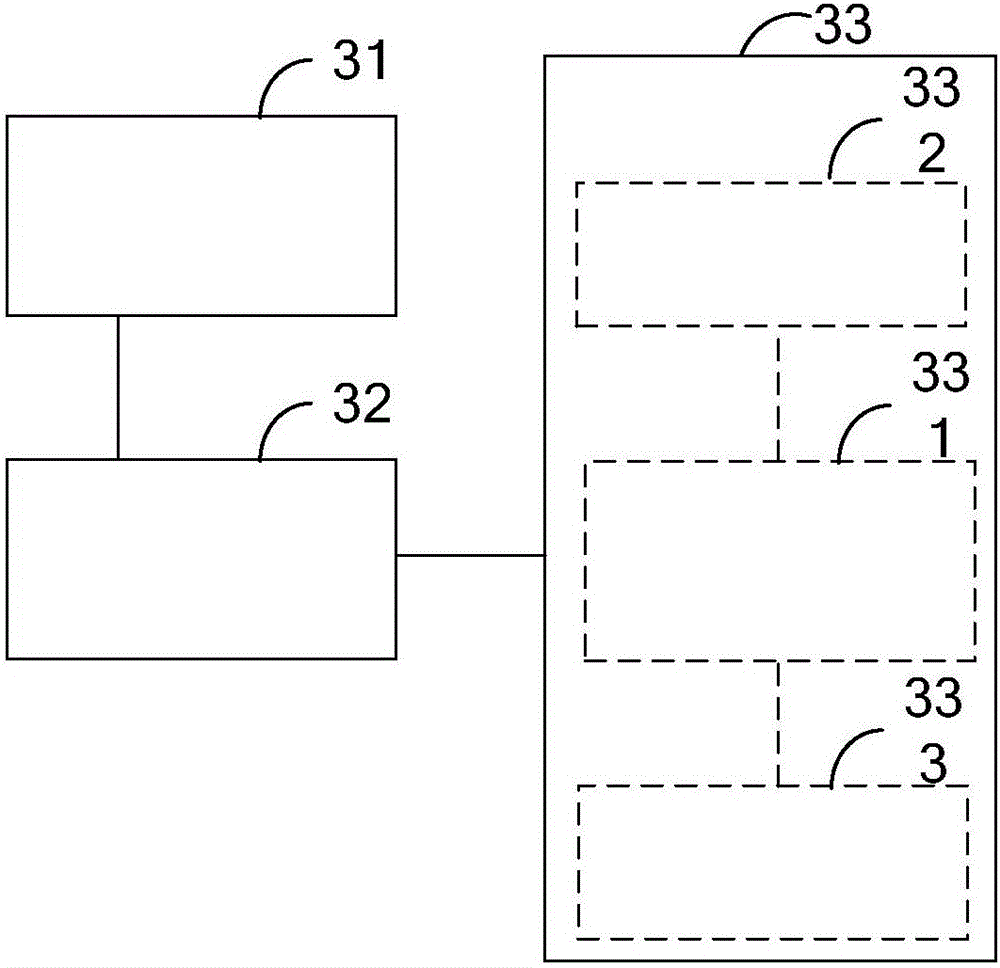

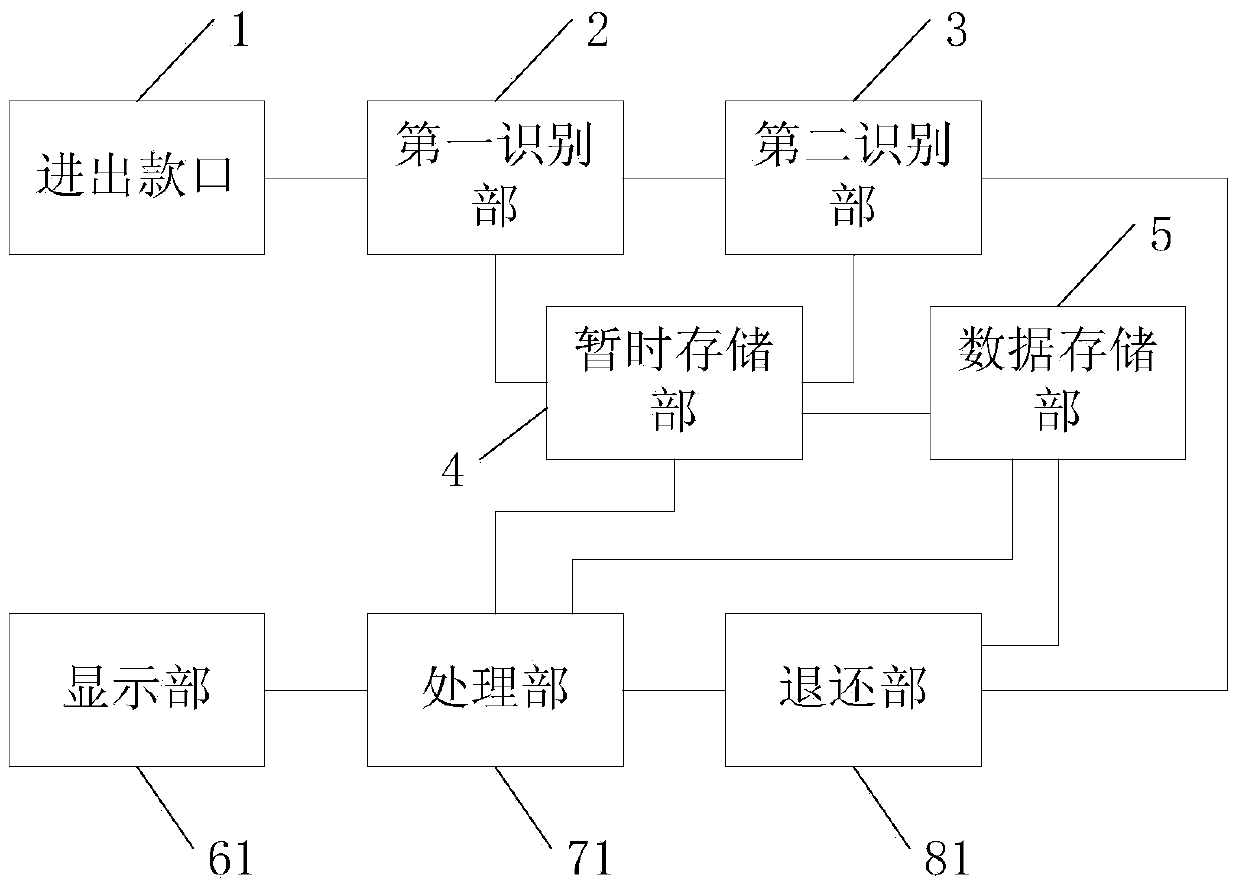

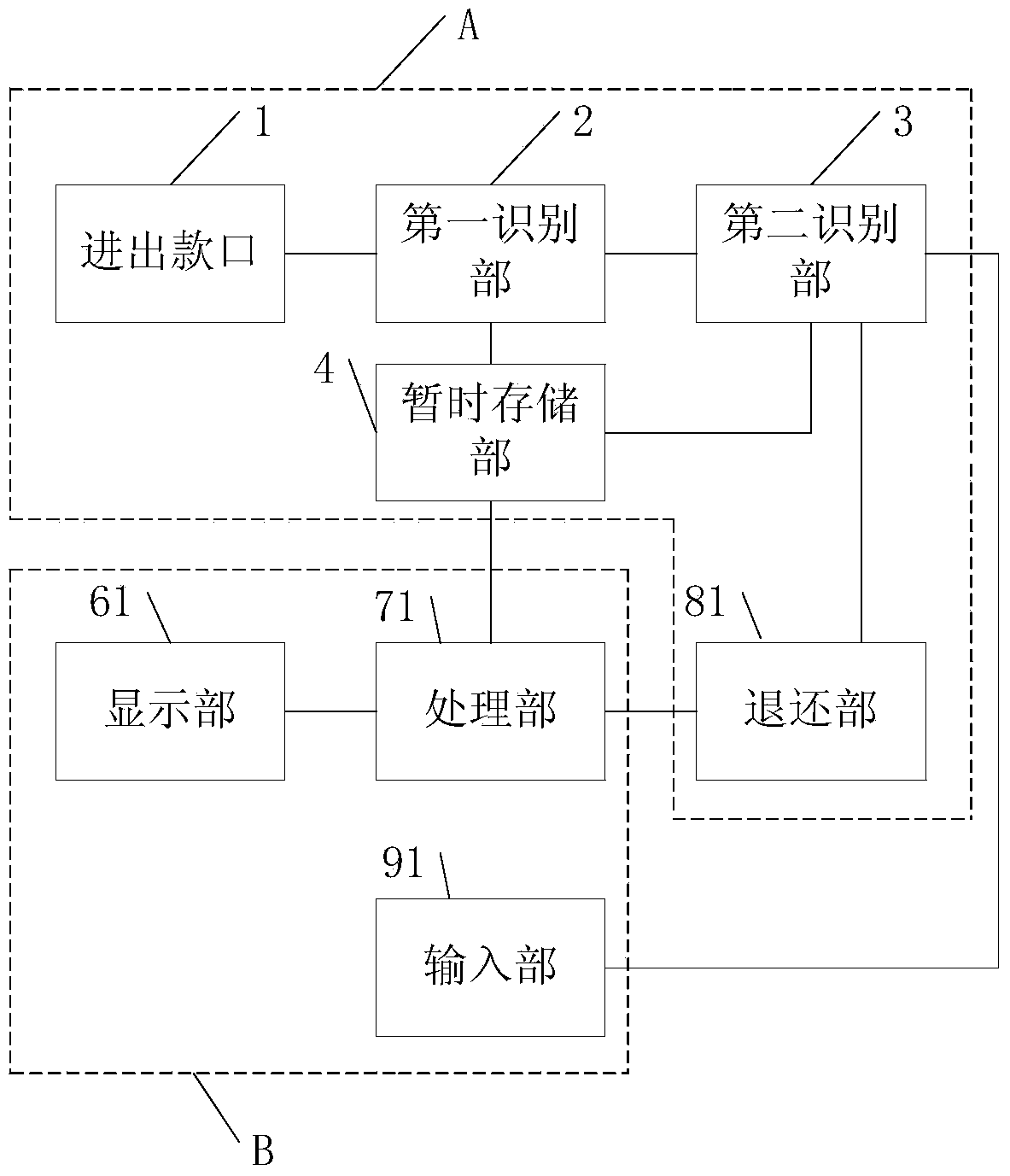

Paper currency receiving and withdrawing system

ActiveCN103996240AGuaranteed accuracyAvoid operabilityCoin/currency accepting devicesPulp and paper industryCurrency amount

The invention discloses a paper currency receiving and withdrawing system which includes a currency receiving and withdrawing port used for receiving and withdrawing of paper currencies; a first identification part which is connected with the currency receiving and withdrawing port and used for identifying the kind and authenticity of received paper currencies; a second identification part which is connected with the first identification part and used for identifying paper currencies which are identified as counterfeit paper currencies by the first identification part; a temporary storage part which is connected with the first identification part and the second identification part and used for storing temporarily real paper currencies identified by the first identification part and real paper currencies identified by the second identification part; a returning part which is connected with the second identification part and used for returning the paper currencies which are identified by the second identification part as counterfeit paper currencies; a processing part which is connected with the temporary storage part and the returning part and used for calculating and obtaining paper currency amount data according to amount data of currencies stored by the temporary storage part and amount data of currencies returned by the returning part; and a display part which is connected with the processing part and used for displaying total paper currency amount data and amount data of currencies stored in the temporary storage part so that the work efficiency of the system is improved.

Owner:SHANGHAI GOOAO ELECTRONIC TECHNOLOGY CORP

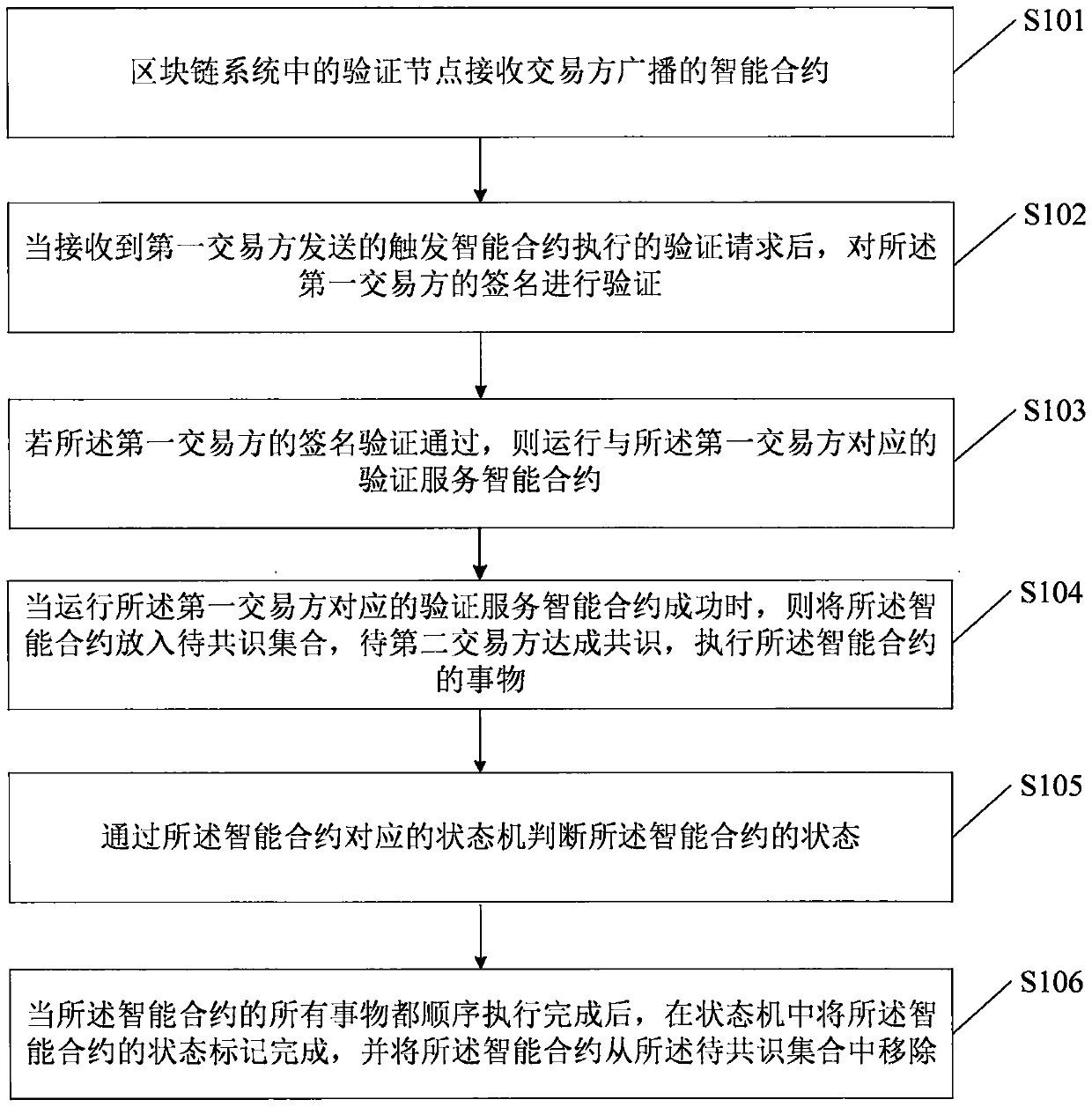

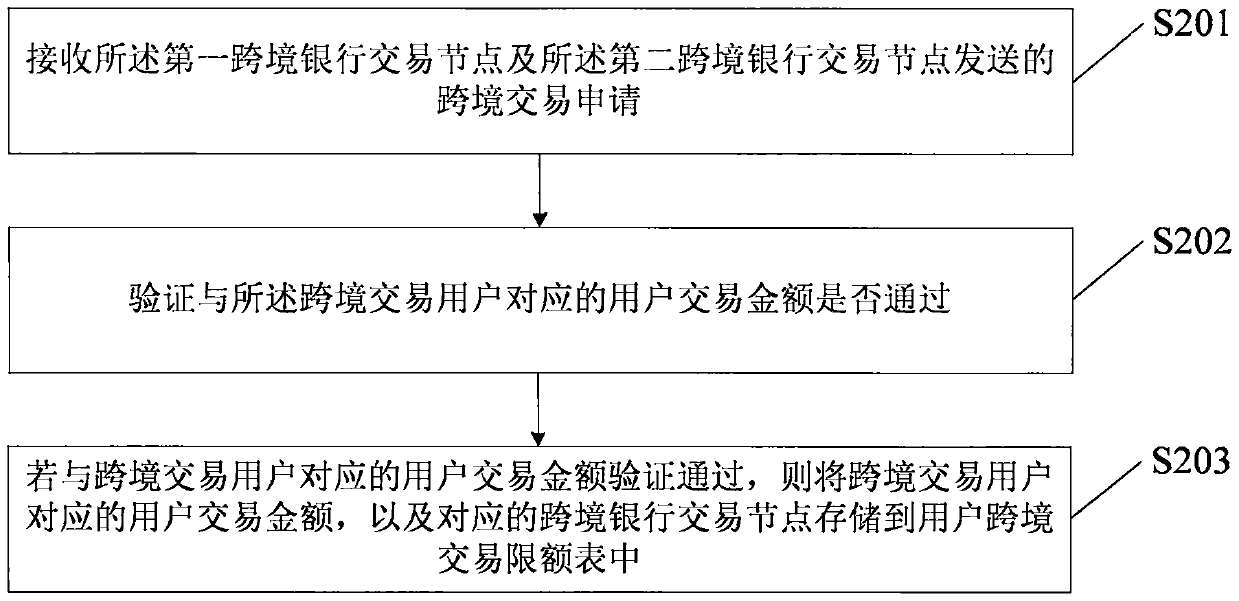

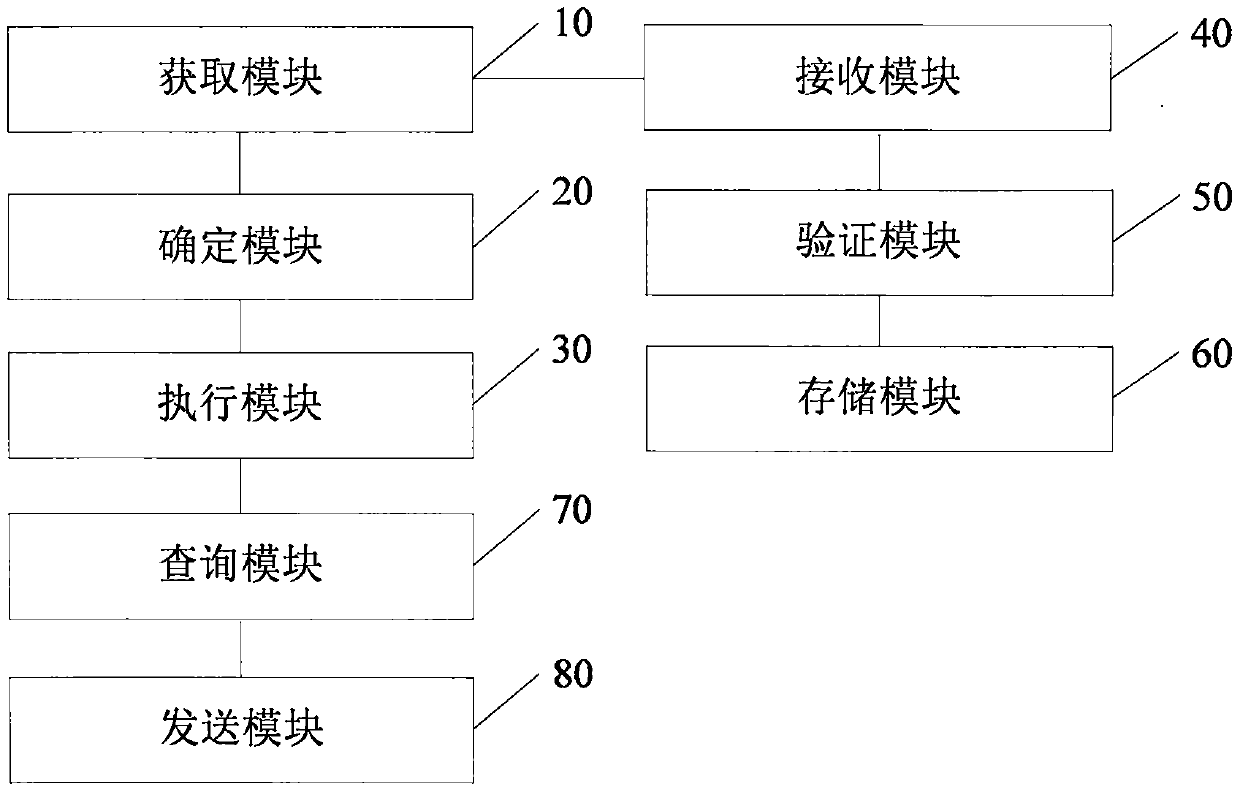

Cross-border transaction method and device based on block chain and hardware equipment

PendingCN111080455AImprove efficiencyReduce agency feesFinancePayment protocolsComputer hardwareFinancial transaction

The invention discloses a cross-border transaction method and device based on a block chain and hardware equipment, relates to the technical field of block chains, and is used for improving the cross-border transaction efficiency and reducing the agent cost of cross-border transaction. According to the main technical scheme, the method comprises the steps of obtaining a submitted transaction country, a target transaction country, a submitted user, a target user and a submitted country transaction amount in a cross-border transaction smart contract; determining an intermediate currency amount corresponding to the transaction amount of the submitted country according to the exchange rate of the submitted transaction country and the intermediate currency in the exchange rate exchange table; determining a target country transaction amount corresponding to the intermediate currency amount according to the exchange rate of the target transaction country and the intermediate currency in the exchange rate exchange table; sending a deduction request to the first cross-border bank transaction node and the second cross-border bank transaction node; and when receiving deduction success information sent by the first cross-border bank transaction node and receiving remittance success information sent by the second cross-border bank transaction node, determining that the cross-border transaction smart contract is successfully executed.

Owner:天津金农企业管理咨询合伙企业(有限合伙)

Electronic purse system and method

The invention discloses an electronic wallet system. The invention comprises a radio element, a control element which is connected with the radio element and is for storing currency amount, and a voice identification element which is connected with the control element and the radio element and permits the radio element to give out an authorization signal if the voice is identified as no error. The invention has the advantages of simple and rapid transaction as well as good protective effect.

Owner:DELTA ELECTRONICS INC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com