Patents

Literature

54 results about "Invoice type" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Pro-forma invoice. Pro-forma invoice can be simply termed as an invoice that gives a rough idea to the buyer about the cost of products and services. This type of invoice is basically referred as estimation or a quote.

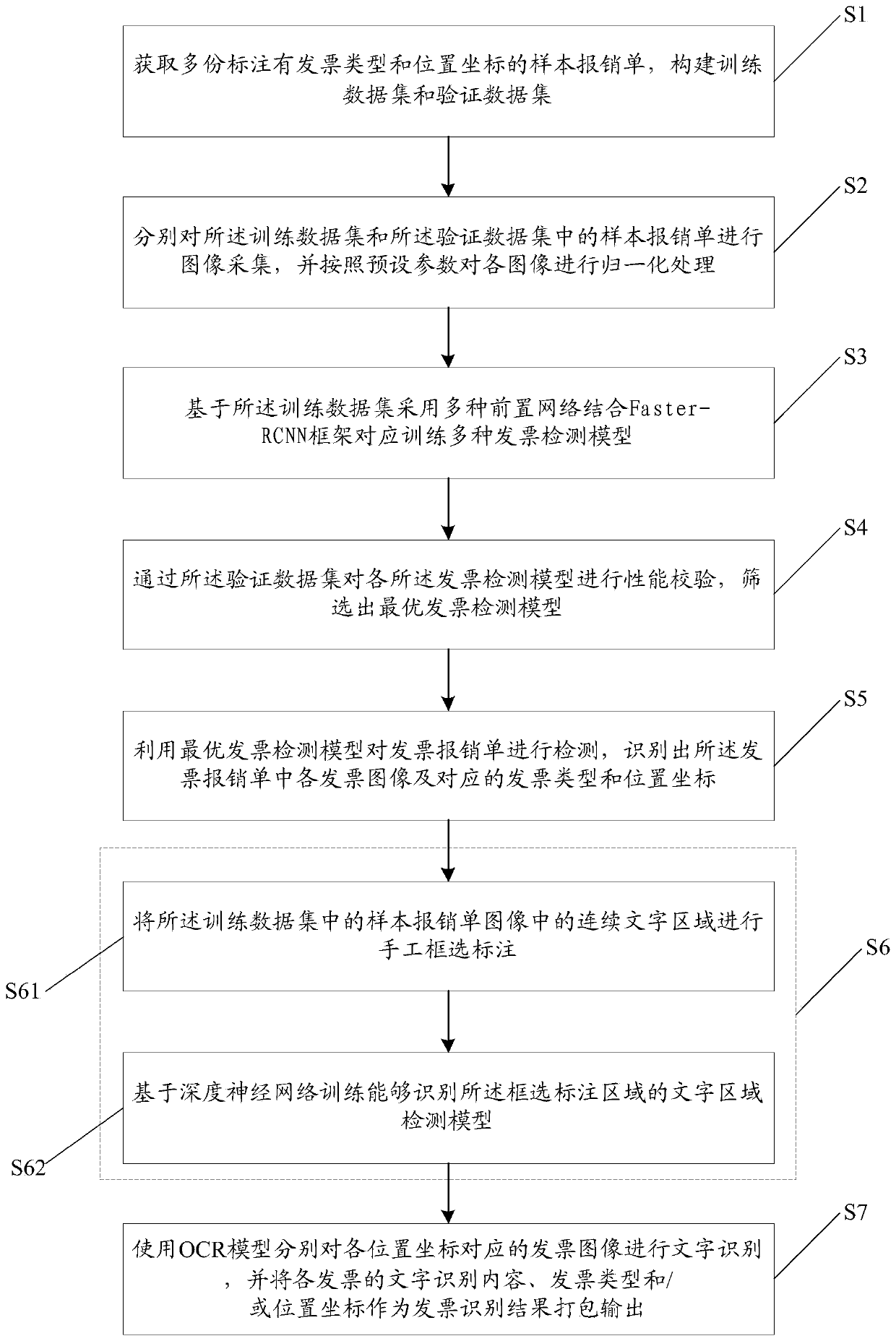

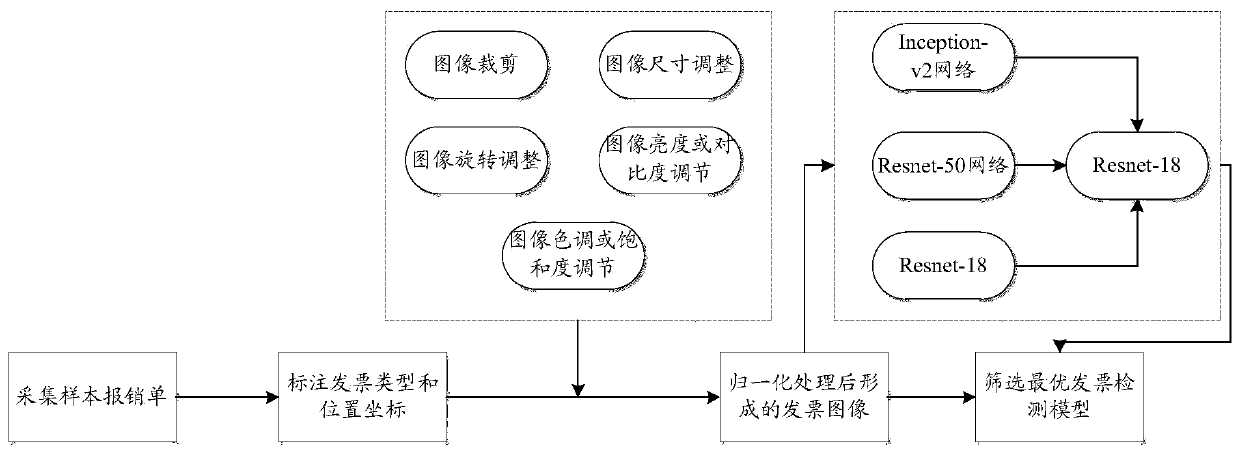

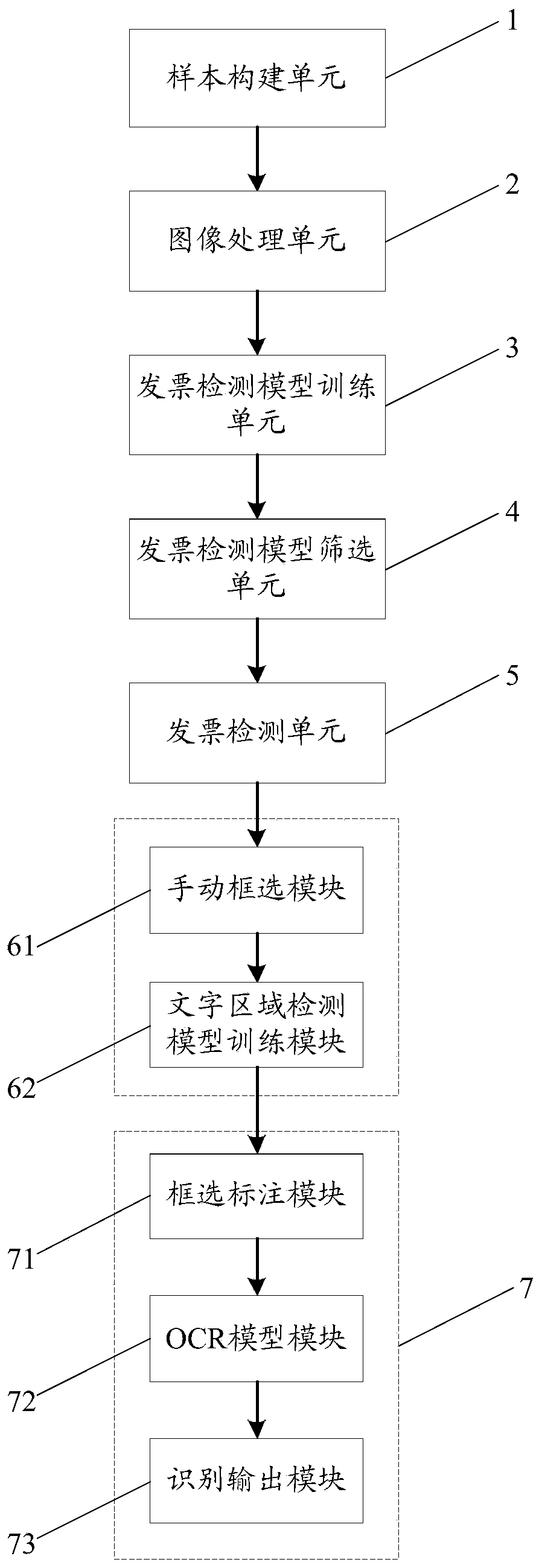

Invoice recognition method and system based on deep learning

InactiveCN109977957AEfficient and accurate identificationGuaranteed validityPaper-money testing devicesNeural architecturesInvoice typeData set

The invention discloses an invoice recognition method and system based on deep learning, relates to the technical field of invoice recognition, and solves the technical problem of inaccurate invoice OCR data acquisition caused by various invoice types and nonstandard invoice pasting in the prior art. The method comprises the following steps: obtaining a plurality of sample reimbursement lists marked with invoice types and position coordinates, and constructing a training data set and a verification data set; based on training data set, combining multiple front networks with a Faster-RCNN framework correspondingly trains a plurality of invoice detection models; carrying out performance verification on each invoice detection model through the verification data set, and screening out an optimal invoice detection model; detecting the invoice reimbursement list by utilizing the optimal invoice detection model, and identifying each invoice image in the invoice reimbursement list and corresponding invoice types and position coordinates; and carrying out character recognition on the invoice images corresponding to the position coordinates by using an OCR model, and packaging and outputtingthe character recognition content, the invoice type and / or the position coordinates of each invoice as invoice recognition results.

Owner:SUNING COM CO LTD

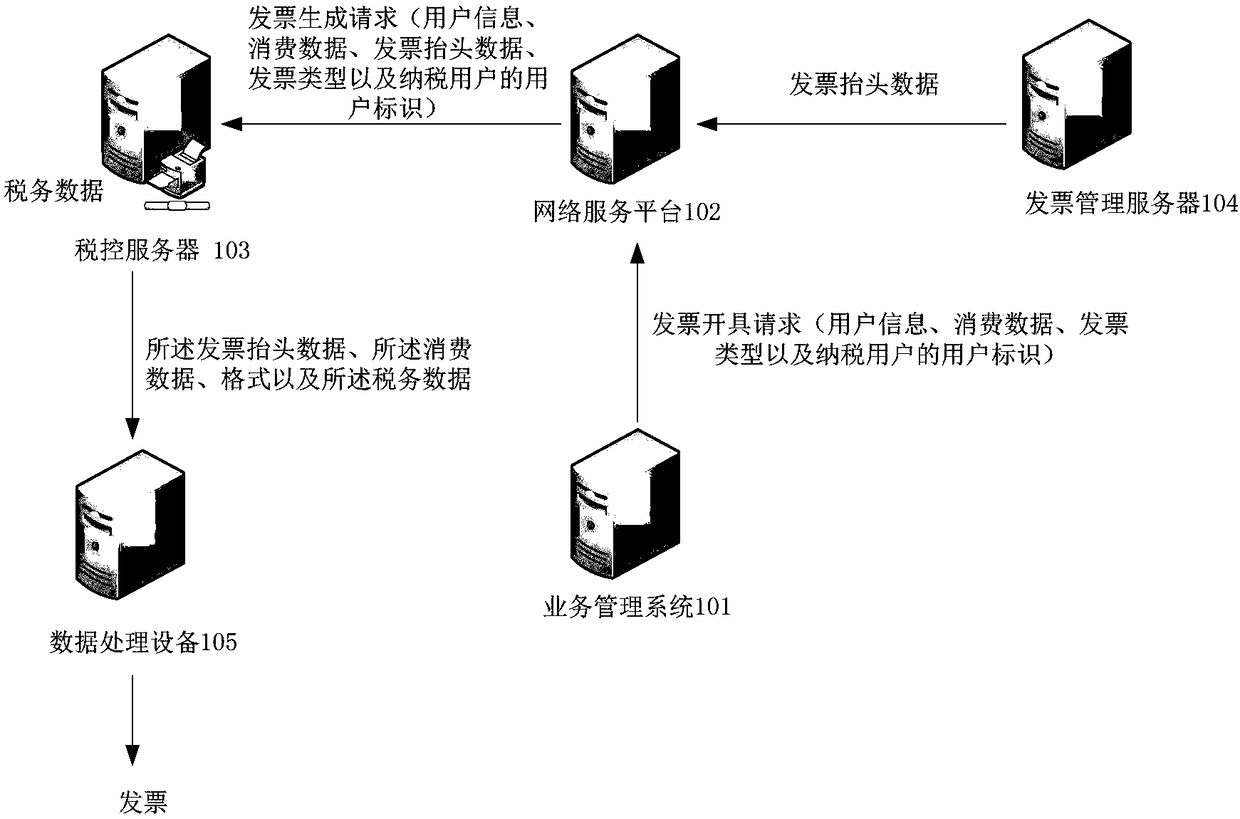

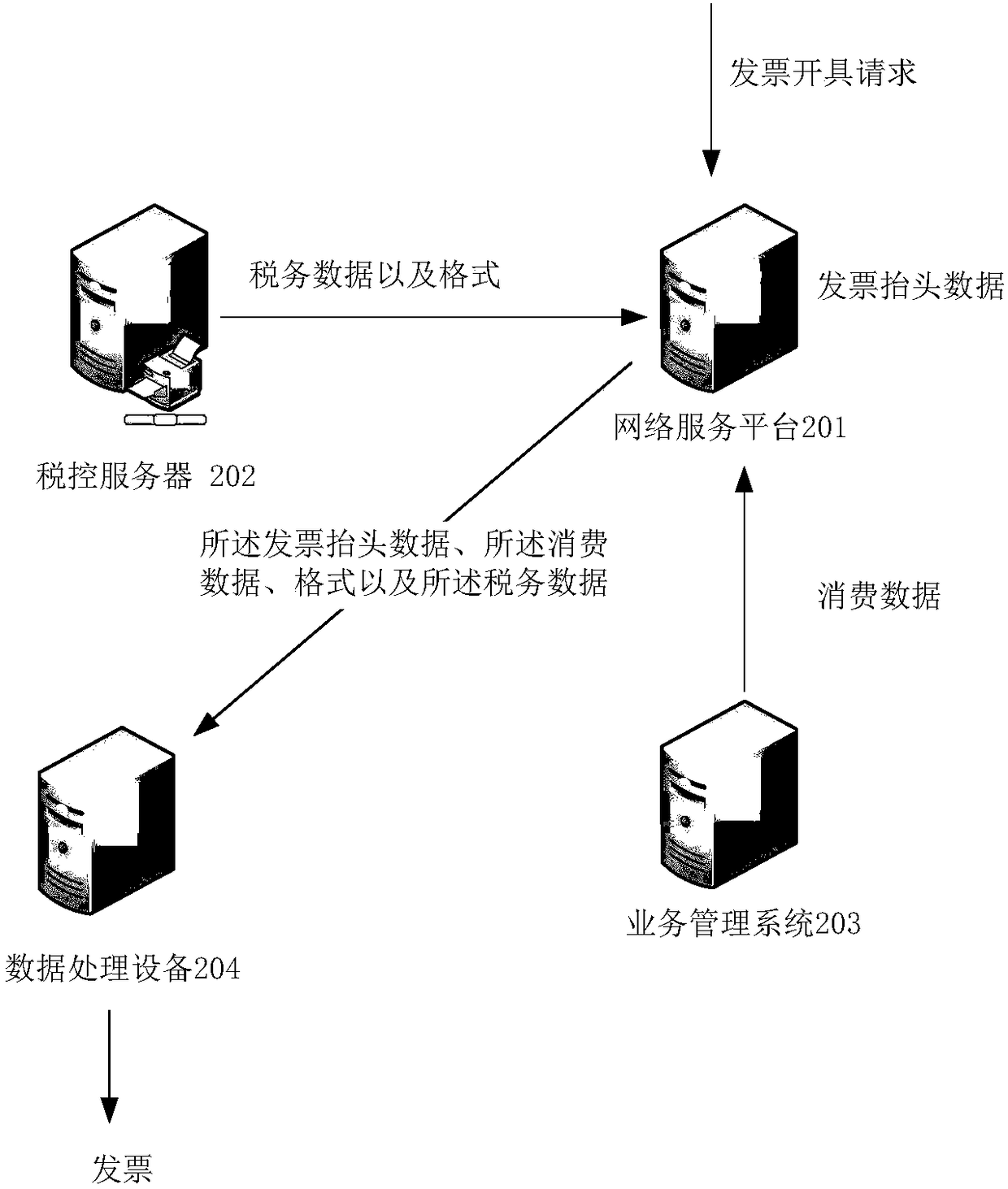

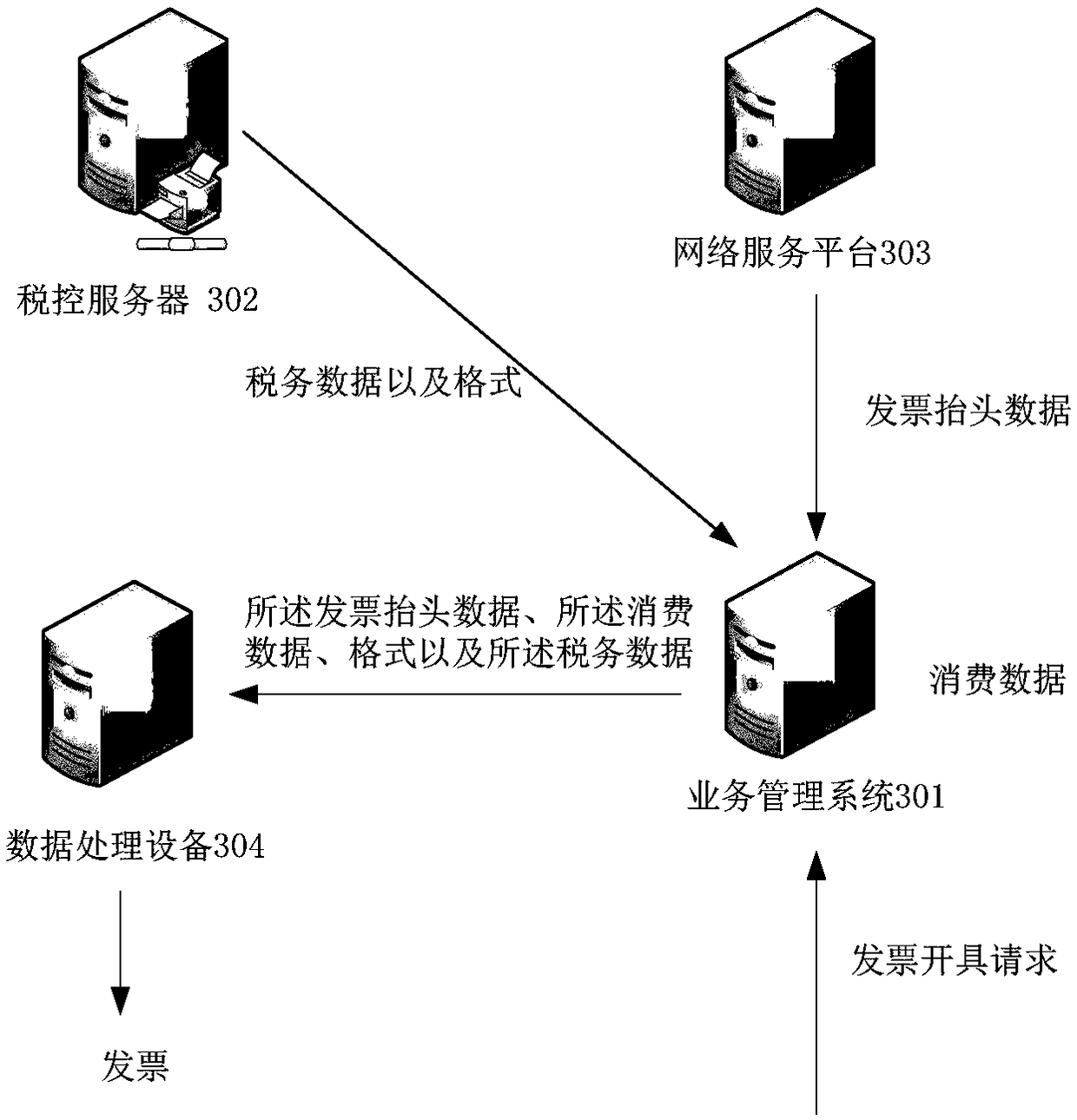

Invoice data processing methods, devices and systems

ActiveCN108122139AImprove experienceChange Acquisition EfficiencyBilling/invoicingInvoice typeUser identifier

The application discloses invoice data processing methods, devices and systems. One of the methods includes: acquiring an invoicing request; finding, according to user information, consumption data related to the user information and invoice title data related to the user information; finding tax data related to a user identifier of an invoiced tax-paying user and a format of an invoice of invoicing according to the invoice type of the invoice of requested invoicing and the user identifier; and obtaining the needed invoice on the basis of the invoice title data, the consumption data and the tax data according to the format. Through realizing data intercommunication among a service management server, a network service platform and a tax controlling server, the Invoice title data, the consumption data and the tax data can be automatically acquired according to information, which is carried in the invoicing request, without the need for inputting the information through a manual manner when the invoicing request is received, that is, the needed invoice can be obtained simply through triggering an invoicing control, and efficiency of invoicing is effectively improved.

Owner:ALIBABA GRP HLDG LTD

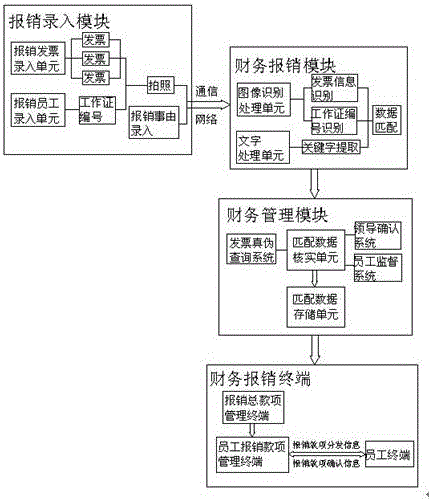

Enterprise financial reimbursement management system

The invention discloses an enterprise financial reimbursement management system. The system comprises a reimbursement type-in module, a financial reimbursement module, a financial management module and a financial reimbursement terminal which are sequentially connected in a transmitted mode; the reimbursement type-in module comprises a reimbursement invoice type-in unit and a reimbursement employee type-in unit; the financial reimbursement module comprises an image identification processing unit and a word processing unit; the financial management module comprises a matching data verification unit and a matching data storage unit; the financial reimbursement terminal comprises a reimbursement total amount management terminal, an employee reimbursement amount management terminal and an employee terminal. According to the enterprise financial reimbursement management system, the complete reimbursement procedures achieve networking, publicity and recycling, data matching and verifying are conducted on reimbursement invoices, employees and reimbursement reasons, and therefore the reimbursement expense accuracy is greatly improved; in addition, the whole reimbursement procedures are monitored in real time, resource sharing between enterprise units and the employees is achieved, and construction of enterprise cost management is promoted.

Owner:太仓安顺财务服务有限公司

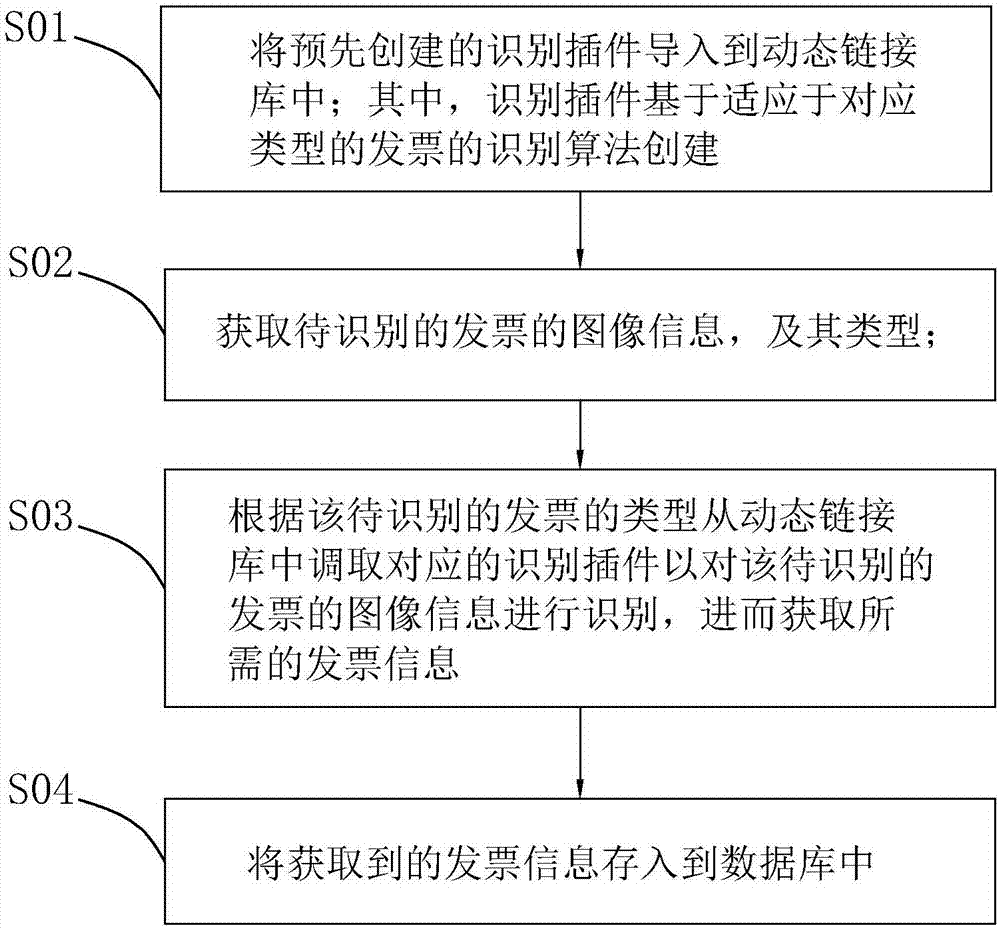

Invoice identifying method based on plug-in, and identifying and management system

ActiveCN107358232ASolve the problem of large amount of information input tasksReduce the burden onCharacter and pattern recognitionInvoice typeRecognition algorithm

The invention discloses an invoice identifying method based on plug-in, and an identifying and management system. The invoice identifying method includes the following steps: guiding a pre-established identifying plug-in to a dynamic link library, wherein the identifying plug-in is established on the basis of an identifying algorithm which corresponds to an invoice type; acquiring image information of a to-be-identified invoice and the type thereof; on the basis of the type of the to-be-identified invoice, invoking a corresponding identifying plug-in from the dynamic link library so as to identify the image information of the to-be-identified invoice and further acquire required invoice information. According to the invention, the invoice identifying method herein has the advantages that: 1. workers can input invoice information, submitting the invoice information to a back stage for an accounting worker to handle so as to reduce accounting worker's burden; and 2. when new type invoice appears, workers can dynamically add identifying algorithm for the type invoice to the system, such that a system can identify the new type invoice and the problem of identifying multiple types of invoices is resolved from an engineering aspect.

Owner:壬华(深圳)科技有限公司

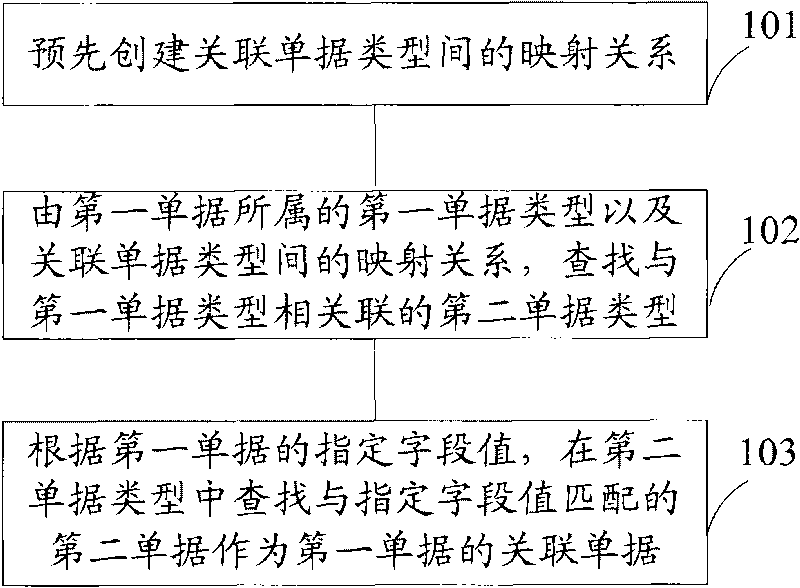

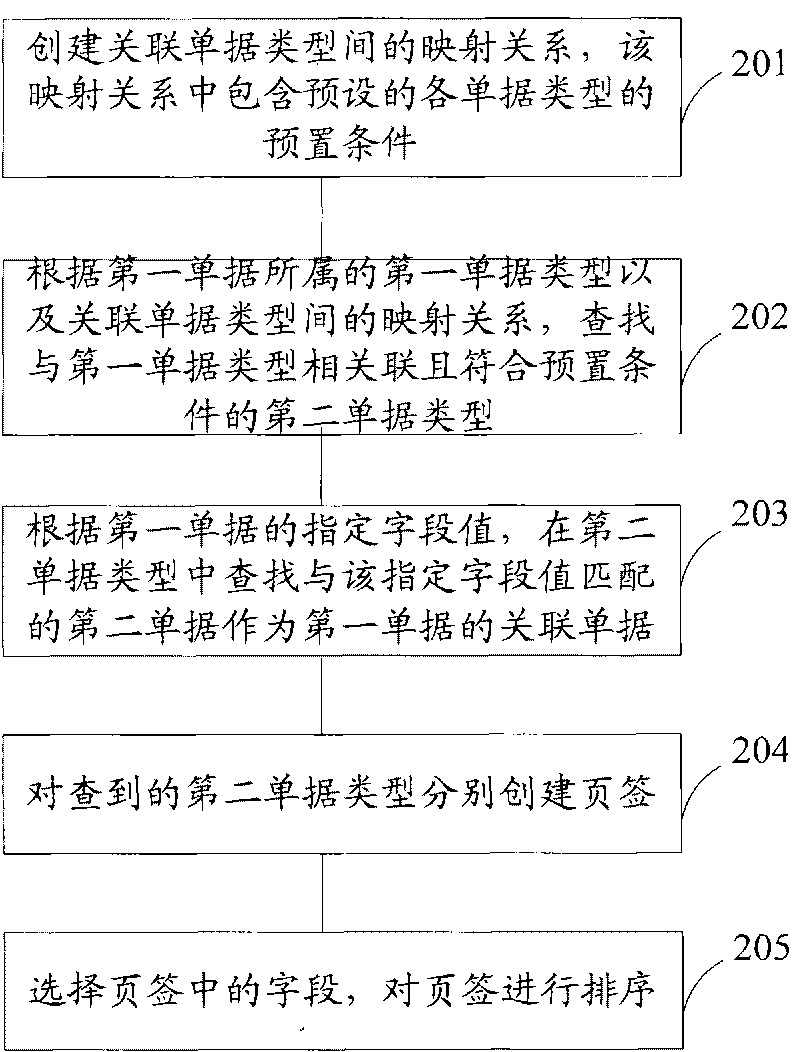

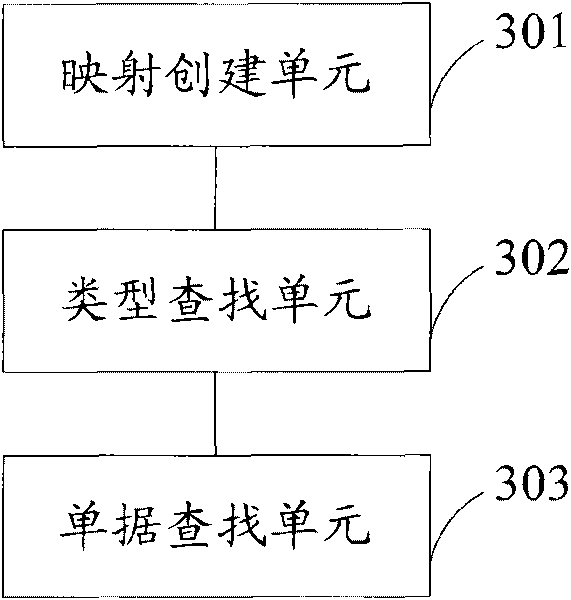

Finding method and system of associated invoice

InactiveCN101706800AEasy to operateImprove search efficiencyResourcesSpecial data processing applicationsInvoice typeData mining

The invention provides a finding method and a system of associated invoice. The finding method of the associated invoice comprises the following steps: finding a second invoice type associated with a first invoice type according to the first invoice type, to which a first invoice belongs, and a pre-established mapping relationship between associated invoice types; and finding a second invoice matched with a designated field value as the associated invoice of the first invoice according to the designated field value of the first invoice. The embodiment of the invention can directly acquire the associated invoice by pre-establishing the mapping relationship between the associated invoice types, and then utilizing the mapping relationship and the designated field, including trans-stage associated invoice, without finding stage by stage, thus simplifying the operation process of finding the associated invoice, and improving finding efficiency.

Owner:KINGDEE SOFTWARE(CHINA) CO LTD

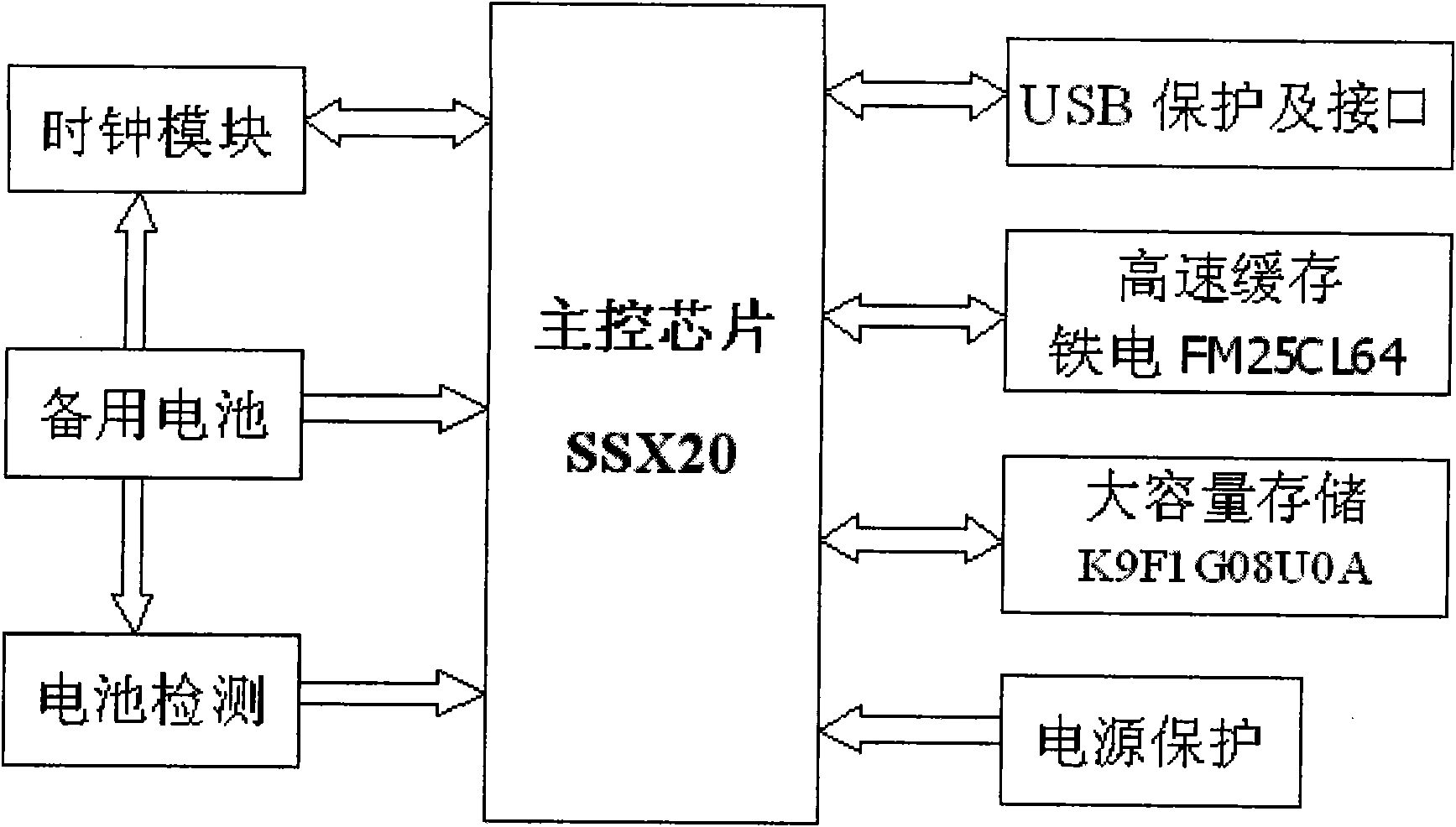

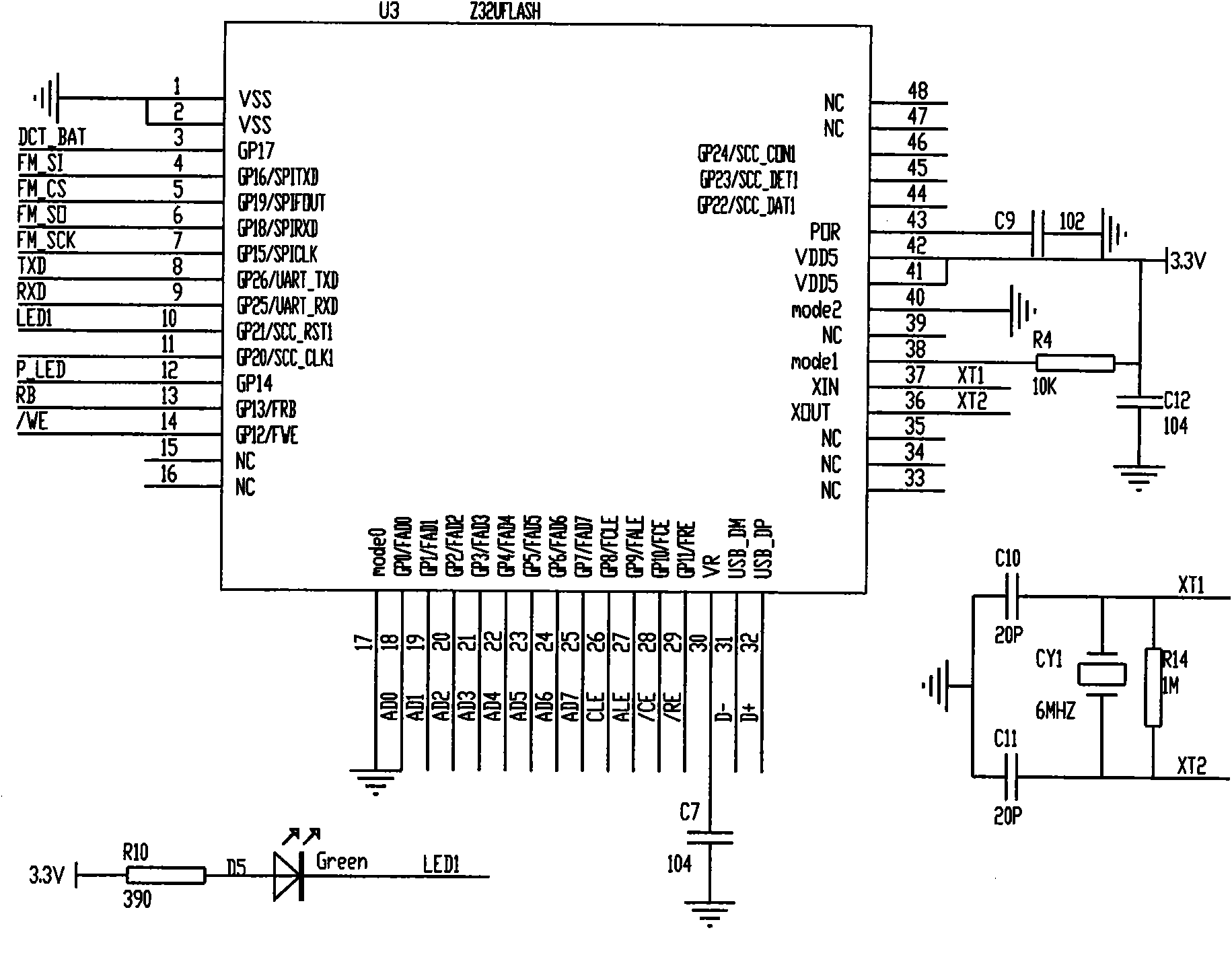

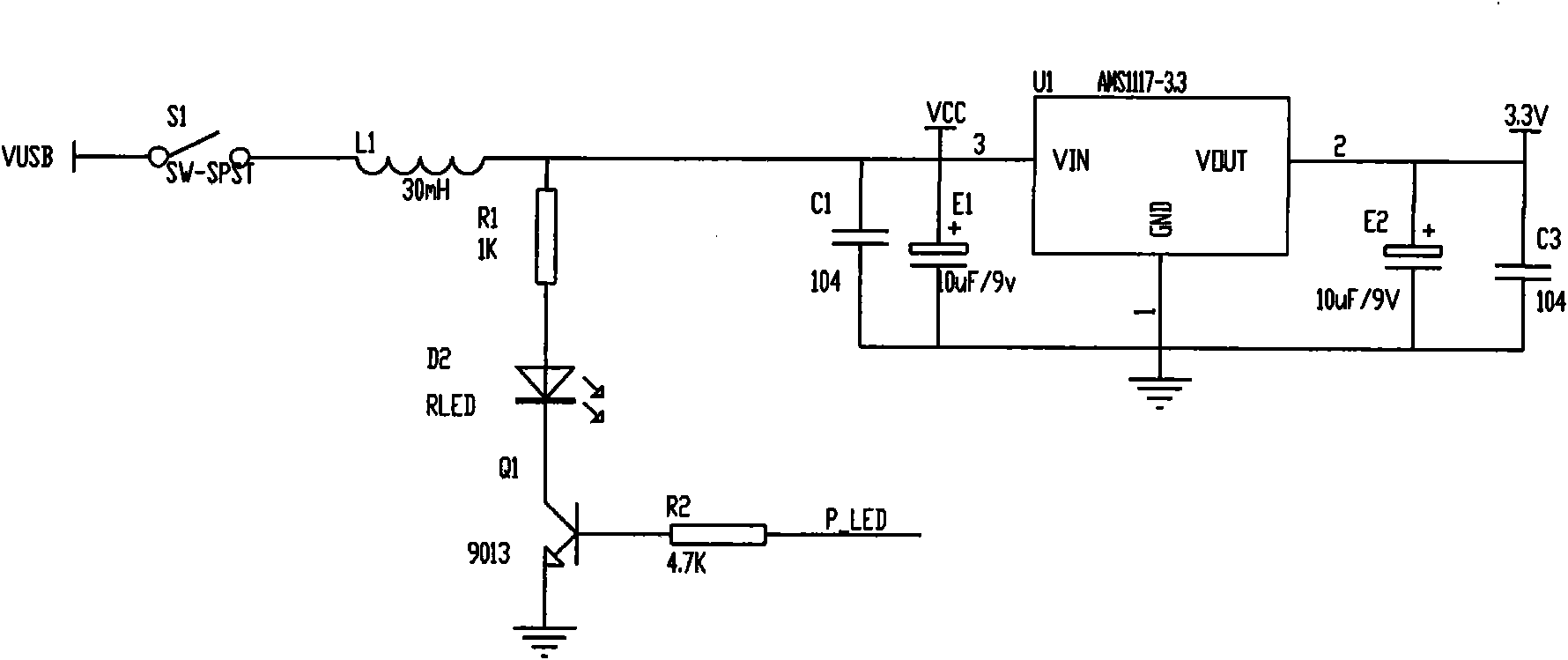

Tax disk

ActiveCN102044115ASimple structural designLow costCash registersSpecial data processing applicationsThree levelSoftware system

The invention discloses a tax disk which comprises a tax disk hardware system and a tax disk software system, wherein the tax disk hardware system comprises a main control chip, a clock module, a power supply module, a storage, a register and a USB (Universal Serial Bus) interface protector which are connected with the main control chip, wherein the power supply module is also connected with the clock module; the tax disk software system comprises a hardware interface layer, a file system management layer, a safety management layer, a tax application layer and a communication interface layer which are connected with the tax disk hardware system; and a three-level index technology is adopted in the file system management system to index invoices. Compared with the traditional tax control device, one tax disk can complete the services of invoice purchasing, invoice making, invoice cancellation, tax copying and the like without other card readers or storage card devices, and can simultaneously support national tax and regional tax, wherein each tax application supports dozens of invoice types.

Owner:HENAN XUJI INFORMATION

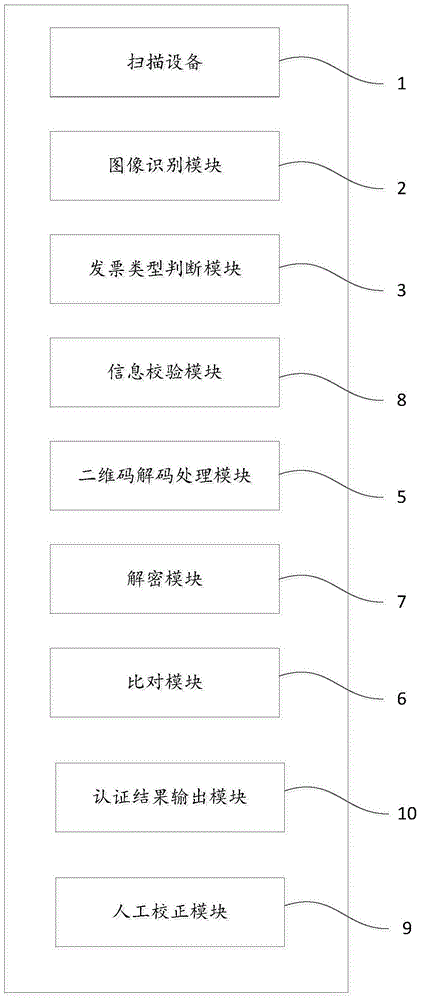

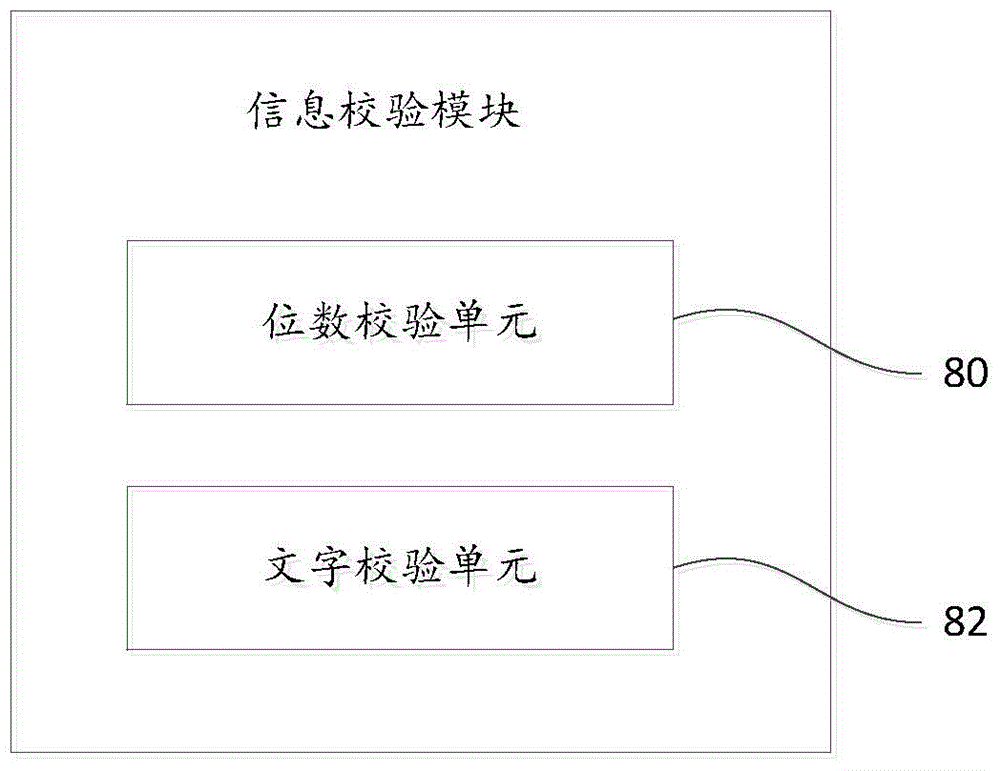

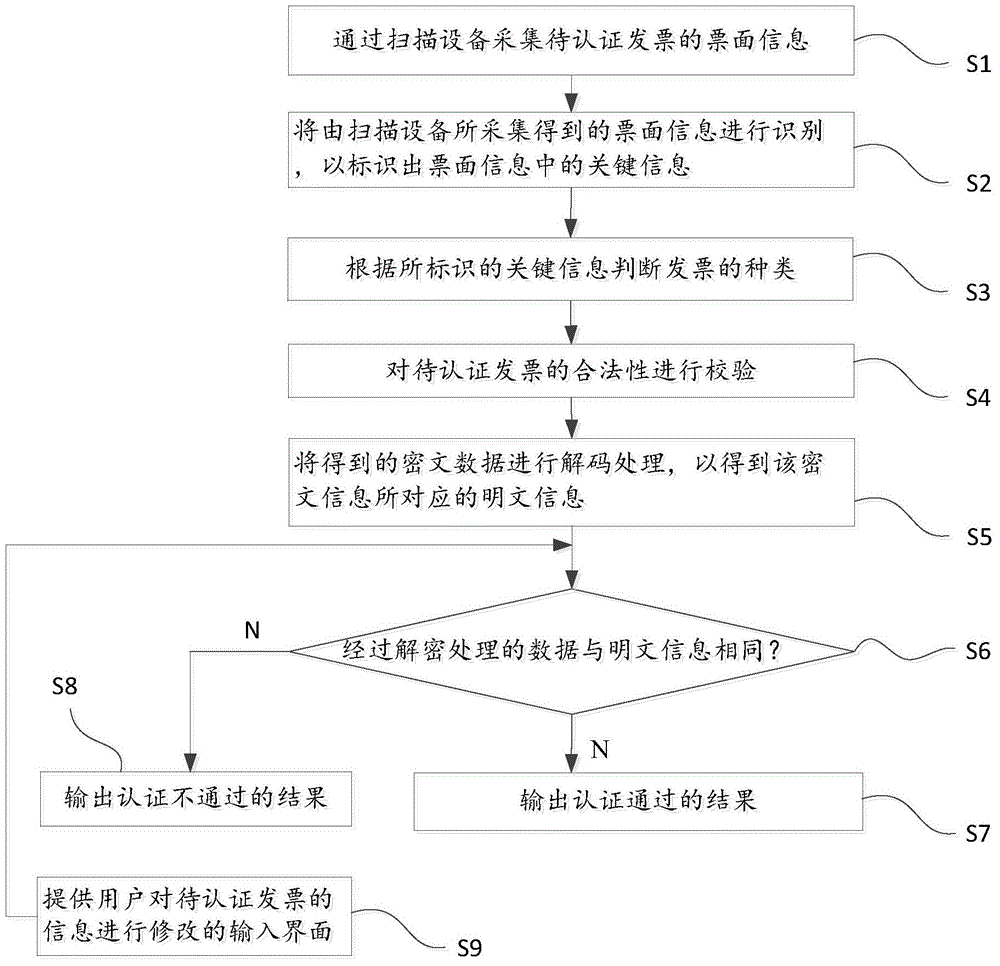

Invoice certification system supporting multiple invoice types and method

InactiveCN105809814AShare the pressureReduce trafficCharacter and pattern recognitionSensing record carriersInvoice typeSoftware engineering

The invention discloses an invoice certification system supporting multiple invoice types. The system comprises the scanning equipment, an image identification module, an invoice type determination module, a two-dimensional decoding processing module, a decryption module, a comparison module and a certification result input module. The invention further discloses an invoice certification method supporting multiple invoice types. Through the method and the system, not only can work burdens of the staff in a working hall be reduced, but also the certification time of taxpayers can be further saved.

Owner:AEROSPACE INFORMATION

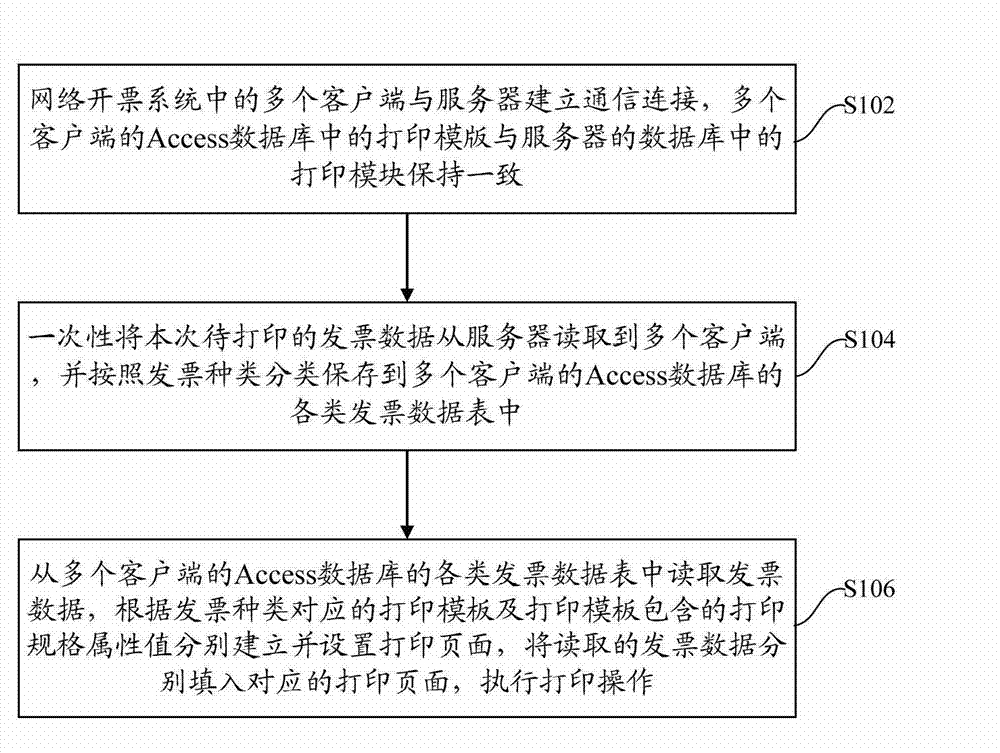

Method and system for improving invoice printing speed of network invoicing system client

ActiveCN103593922AIncrease printing speedAvoid the problem of operating too frequentlyCash registersInvoice typeData bank

The invention discloses a method and system for improving invoice printing speed of a network invoicing system client. The method comprises the following steps: multiple clients in a network invoicing system establishing communication connection with a server; the printing templates of the Access databases of the multiple clients maintaining consistent with the printing templates of the database of the server; invoice data to be printed this time being read from the server to the multiple clients at a time, and being classified and stored to various kinds of invoice data sheets of the Access databases of the multiple clients according to invoice types, wherein the invoice data comprises main information, detail information and list information; and reading the invoice data from the various kinds of invoice data sheets of the Access databases of the multiple clients, respectively establishing and setting printing pages according to printing templates corresponding the invoice types and printing specification attribute values included in the printing templates, respectively filling the read invoice data to the corresponding printing pages, and executing printing operation.

Owner:AEROSPACE INFORMATION

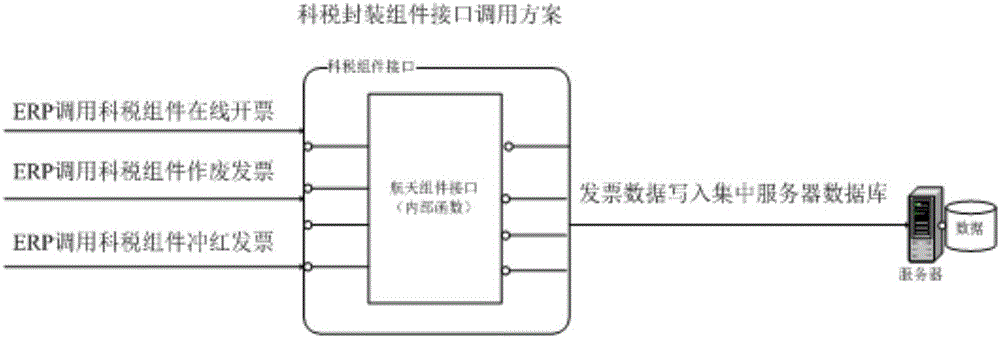

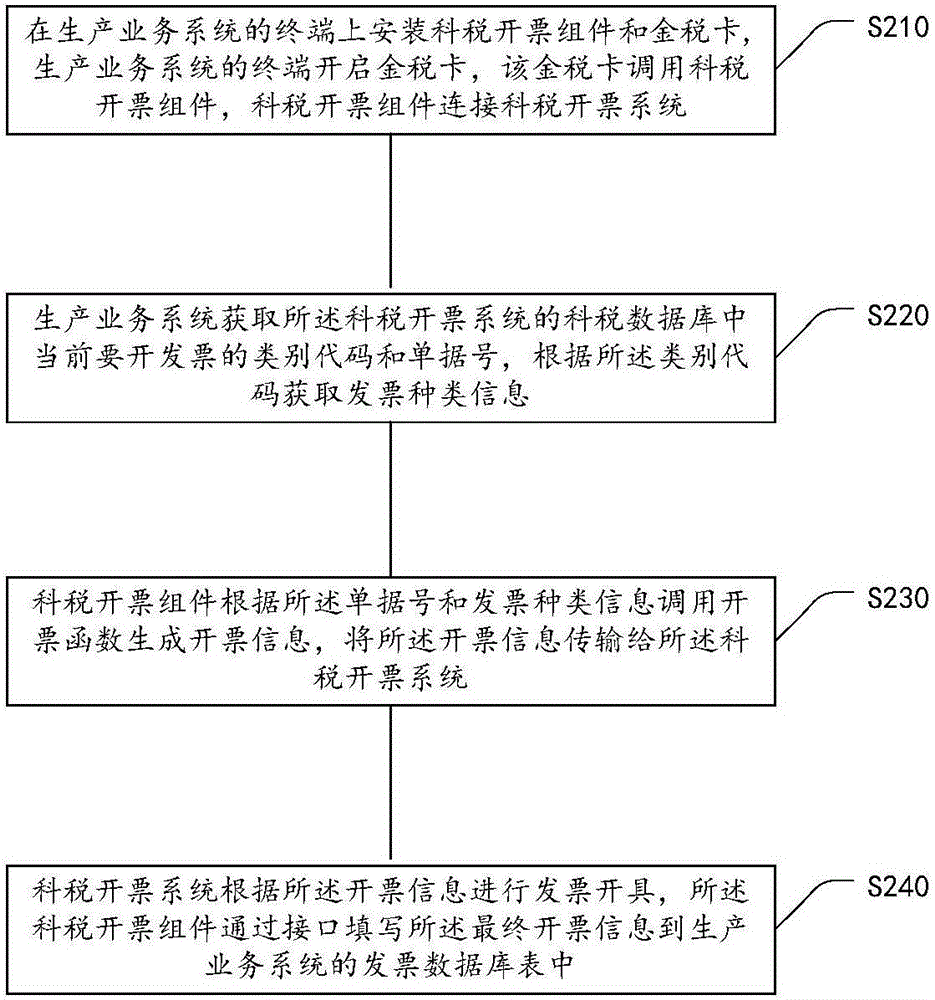

Method for realizing tax invoicing system universal interface on the basis of production service system

The embodiment of the invention provides a method for realizing a tax invoicing system universal interface on the basis of a production service system. The method comprises the following steps: a terminal of the production service system starting a gold tax card, wherein the gold tax card schedules a tax invoicing assembly, and the tax invoicing assembly is connected with a tax invoicing system; the production service system obtaining type codes and document numbers of invoices to be issued currently in a tax database and obtaining invoice type information according to the type codes, and the tax invoicing assembly, according to the document numbers and the invoice type information, scheduling an invoicing function to generate invoicing information and transmitting the invoicing information to the tax invoicing system; and the tax invoicing system, according to the invoicing information, performing invoice issuing, and the tax invoicing assembly writing the invoicing information to an invoice database table of the production service system through the interface. According to the invention, the invoicing information in the tax invoicing system can be read by the production service system, the tax invoicing assembly reads invoicing data from the tax invoicing system, and data sharing is carried out between the production service system and the tax invoicing system.

Owner:BEIJING JIAOTONG UNIV

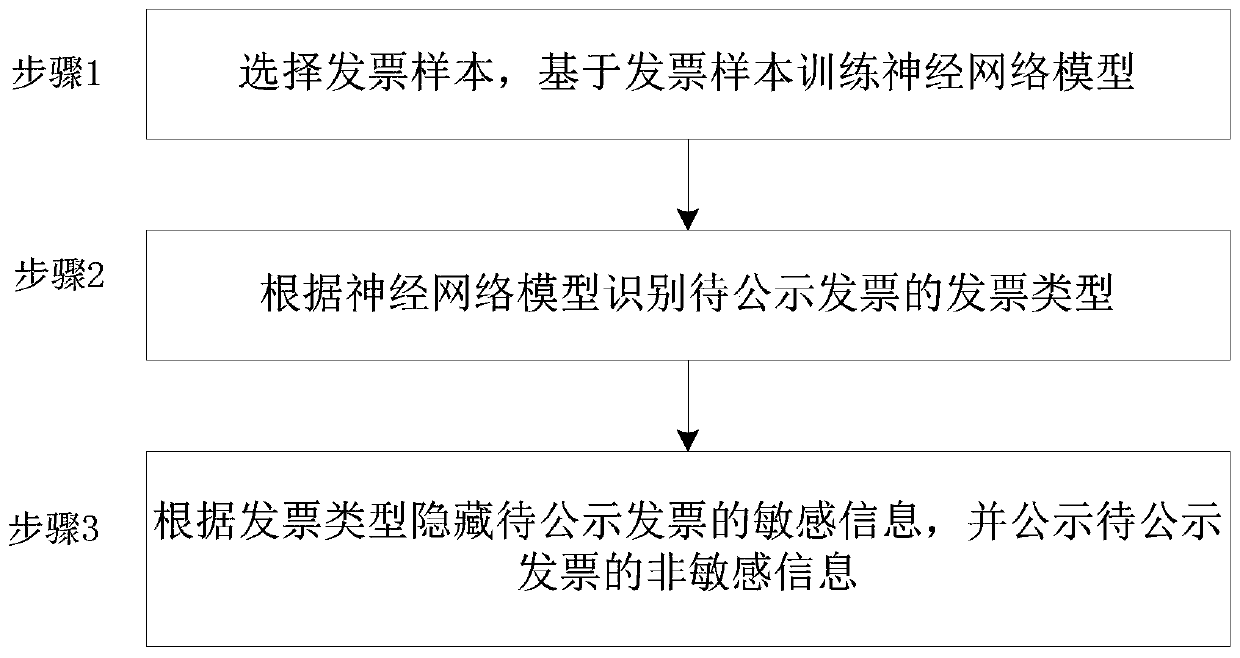

An invoice announcement method and system based on a neural network

InactiveCN109815949AEnsure safetyImprove accuracyCharacter and pattern recognitionDigital data protectionInvoice typeNetwork model

The invention discloses an invoice announcement method and system based on a neural network, and the method comprises the steps: 1, selecting an invoice sample, and training a neural network model based on the invoice sample; 2, identifying the invoice type of the invoice to be publicized according to the neural network model; and step 3, hiding the sensitive information of the invoice to be publicized according to the invoice type, and publicizing the non-sensitive information of the invoice to be publicized. According to the invention, privacy disclosure during invoice announcement can be avoided, and invoice rationalization announcement and application are facilitated.

Owner:AEROSPACE INFORMATION

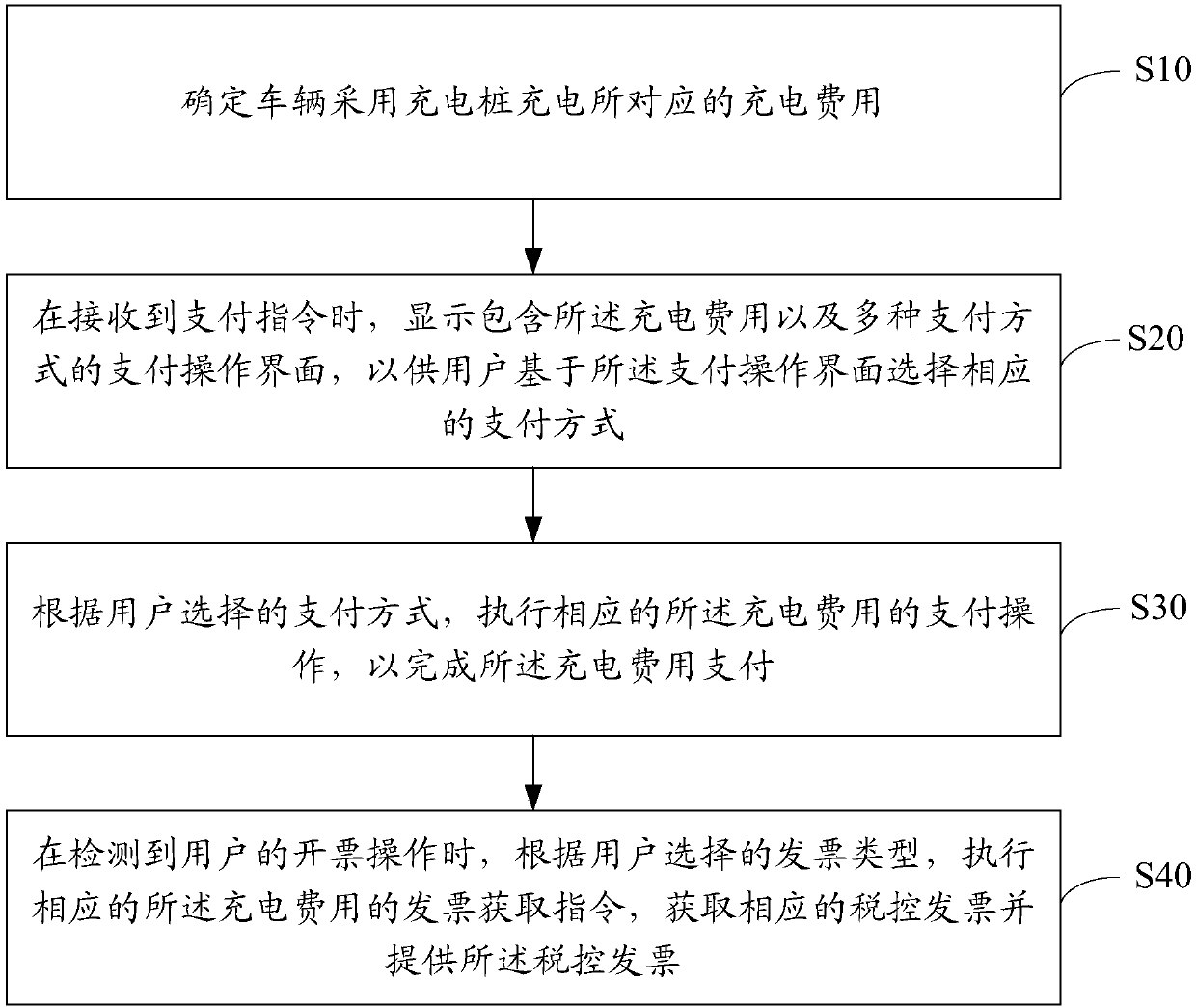

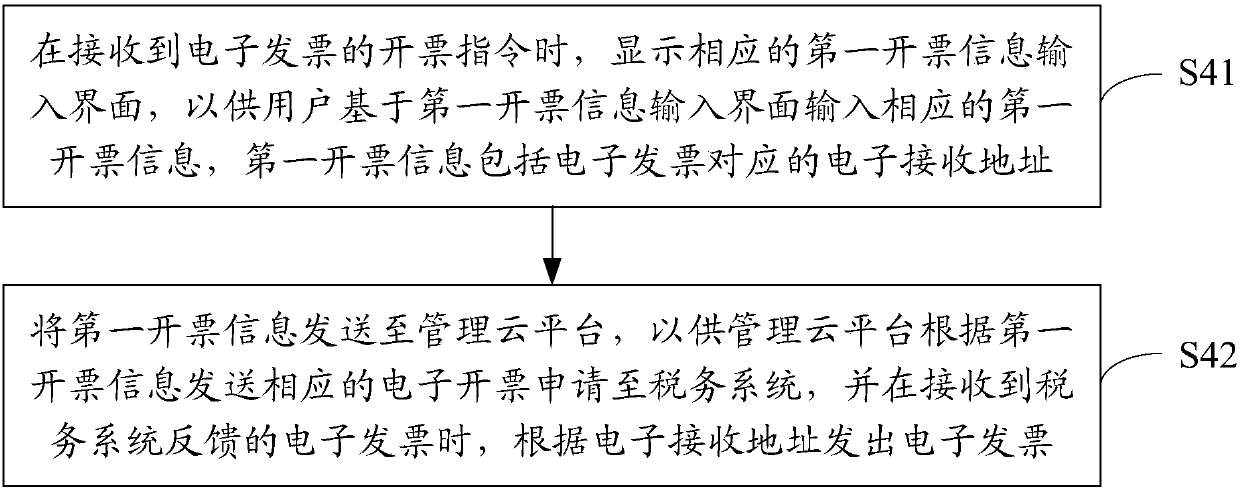

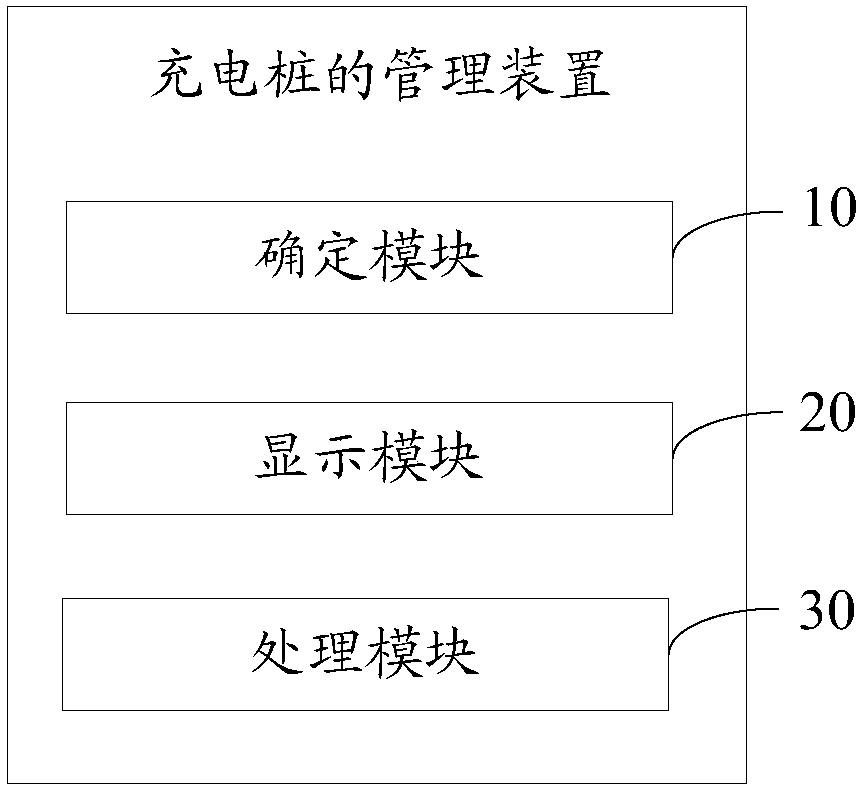

Charging pile management method and apparatus

InactiveCN107730236AIncrease flexibilityImprove conveniencePayment architectureBuying/selling/leasing transactionsInvoice typePayment

The invention discloses a charging pile management method. The method comprises the steps of determining a corresponding charging fee when a vehicle is charged by adopting a charging pile; when a payment instruction is received, displaying a payment operation interface comprising the charging fee and multiple payment modes, thereby enabling a user to select the corresponding payment mode based onthe payment operation interface; according to the payment mode selected by the user, executing payment operation of the corresponding charging fee to finish charging fee payment; and when invoicing operation of the user is detected, executing an invoice obtaining instruction of the corresponding charging fee according to an invoice type selected by the user, obtaining a corresponding tax control invoice and providing the tax control invoice. The invention furthermore discloses a charging pile management apparatus. The convenience of charging the vehicle by adopting the charging pile is improved.

Owner:XIAN IRAIN IOT TECH SERVICES CO LTD

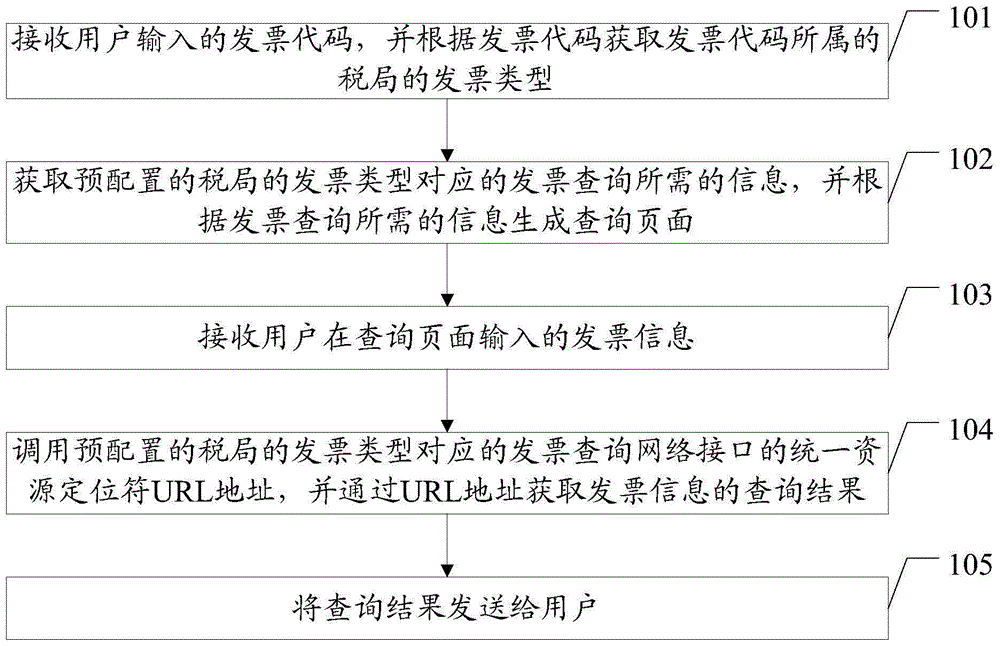

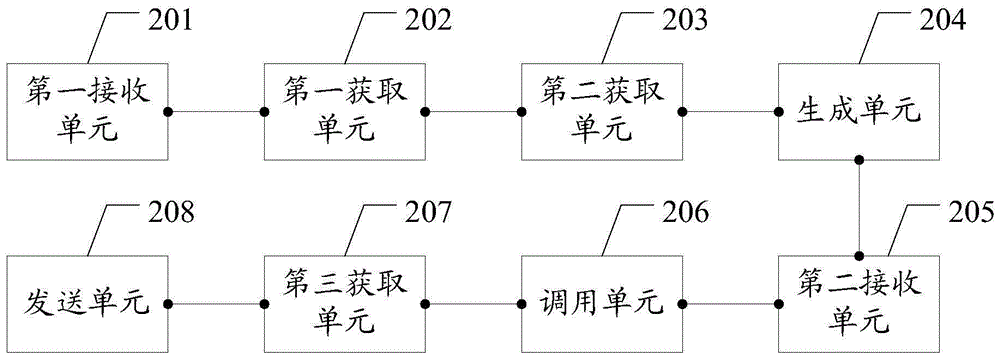

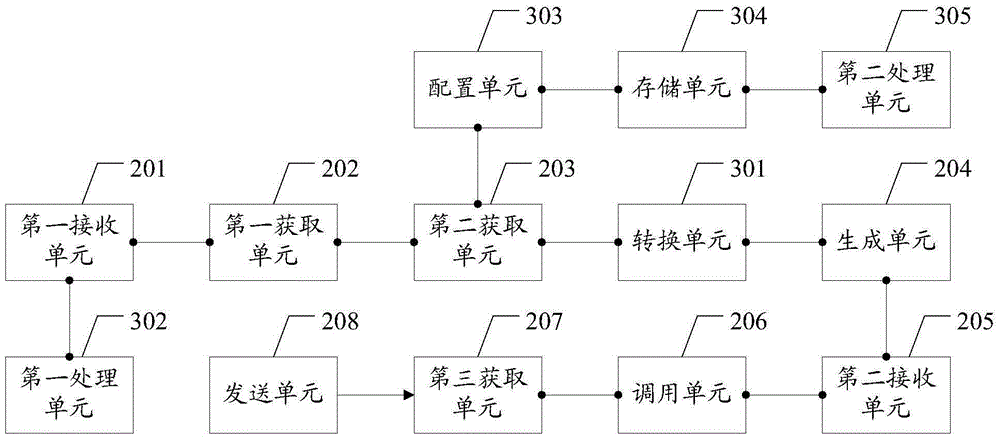

Invoice query method and device

InactiveCN105205706ASolve the problems that need to be adjusted at both the front and rear endsImprove execution efficiencyBilling/invoicingSpecial data processing applicationsInvoice typeUser input

An embodiment of the invention discloses an invoice query method and device so as to improve execution efficiency and save cost of development. The method comprises the following steps: receiving invoice codes input by a user, and obtaining the invoice type of a tax bureau where the invoice codes belong according to the invoice codes; obtaining information required for invoice query corresponding to the pre-configured invoice type of the tax bureau, and generating a query page according to the information required for invoice query; receiving invoice information input by the user in the query page; calling a uniform resource locator (URL) address of an invoice query network interface corresponding to pre-configured invoice type of the tax bureau, and obtaining a search result of the invoice information through the URL address; and sending the search result to the user.

Owner:深圳市金蝶精斗云网络科技有限公司

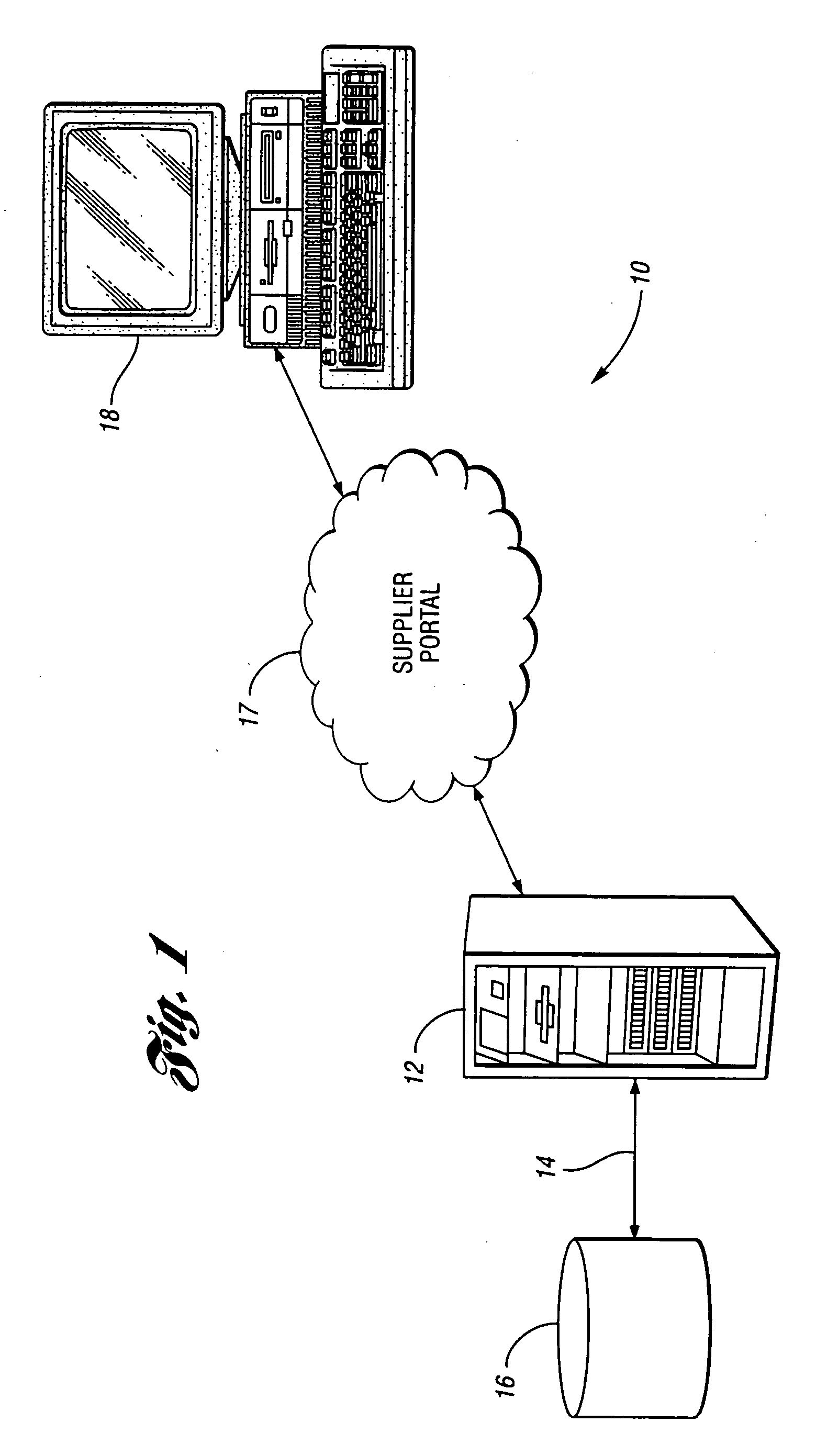

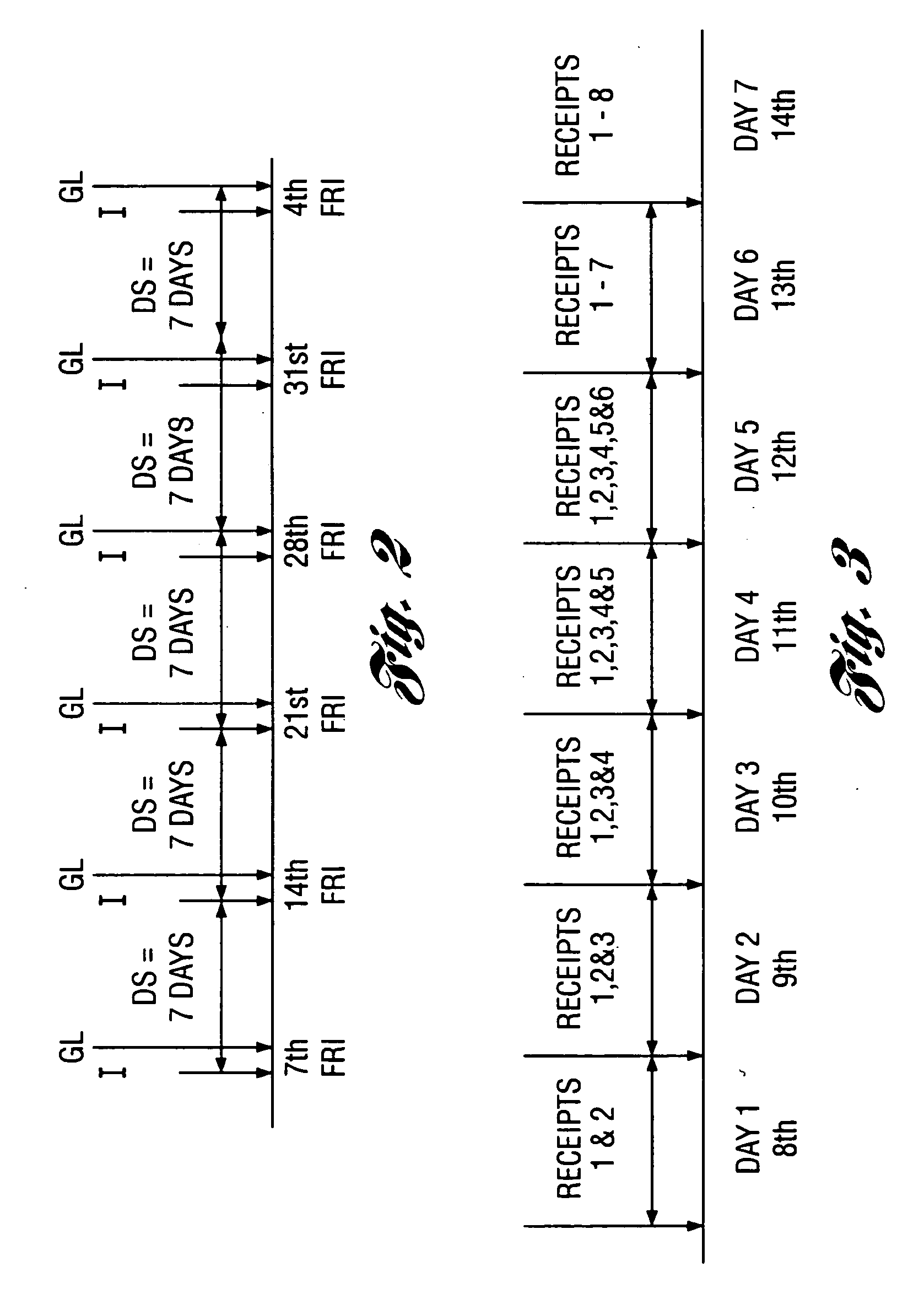

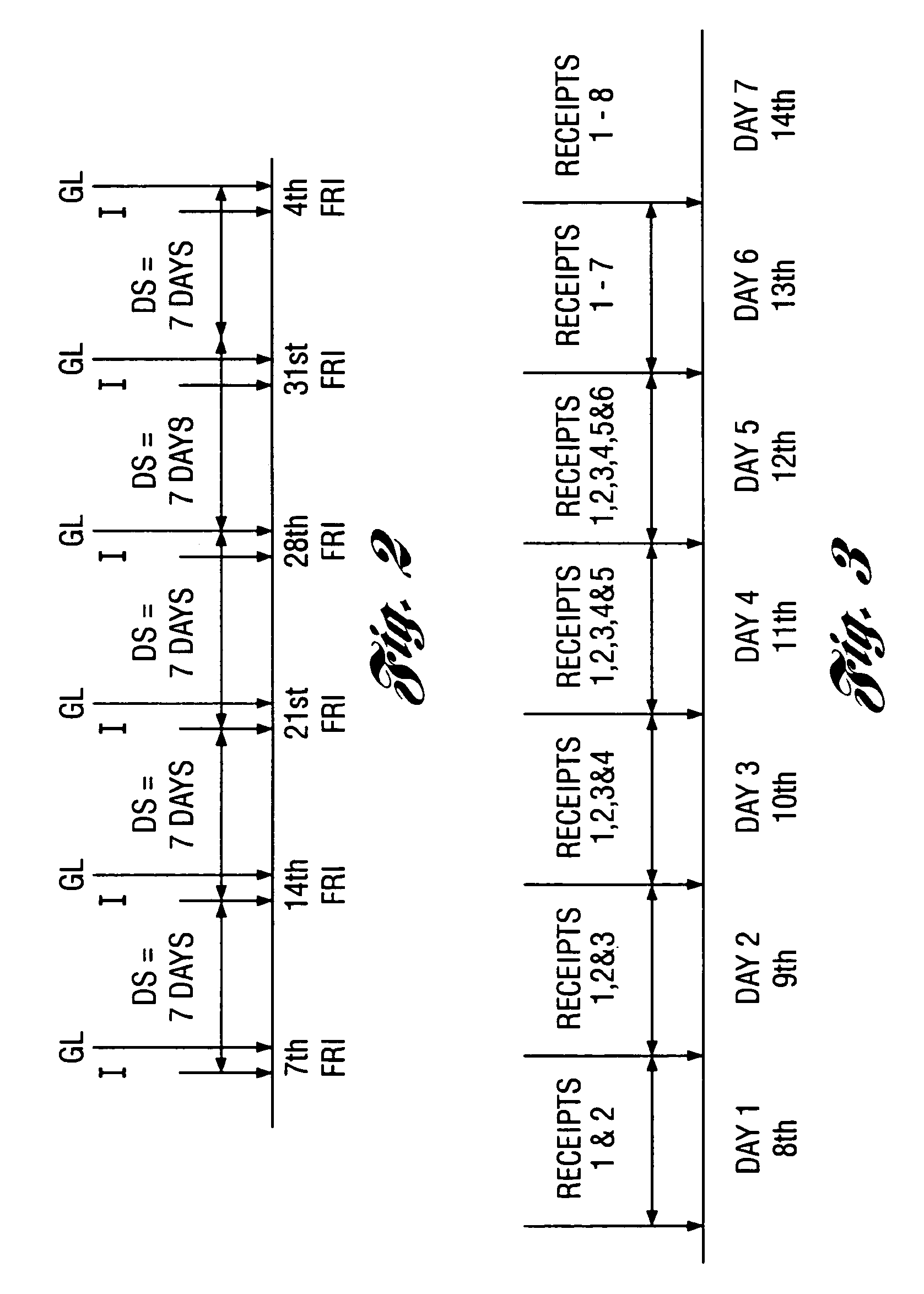

Computer-implemented method and system for grouping receipts

A computer-implemented method for summarizing receipts and grouping the receipts onto one or more invoices. The method includes receiving a number of receipts and a time period including a start date and an end date, summarizing the receipts in the number of receipts having an approval date in the time period to obtain a number of summarized receipts, and grouping the summarized receipts to obtain one or more grouped invoices based on two of a number of grouping rules, the number of grouping rules including grouping by supplier pay site code, grouping by payment currency, grouping by receipt number, to grouping by payment term, grouping by value date, grouping by invoice type, and grouping by tax rules.

Owner:FORD MOTOR CO

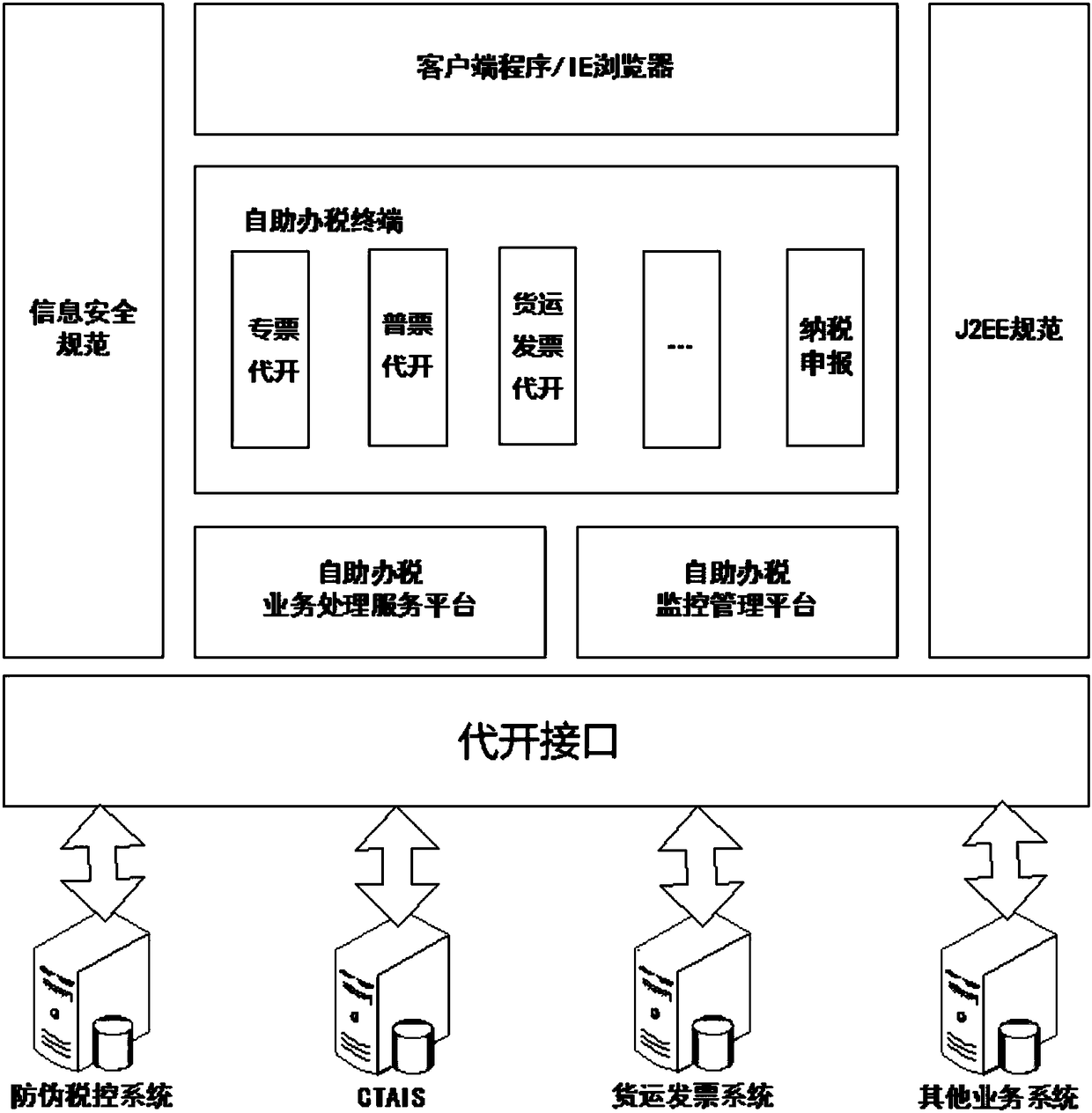

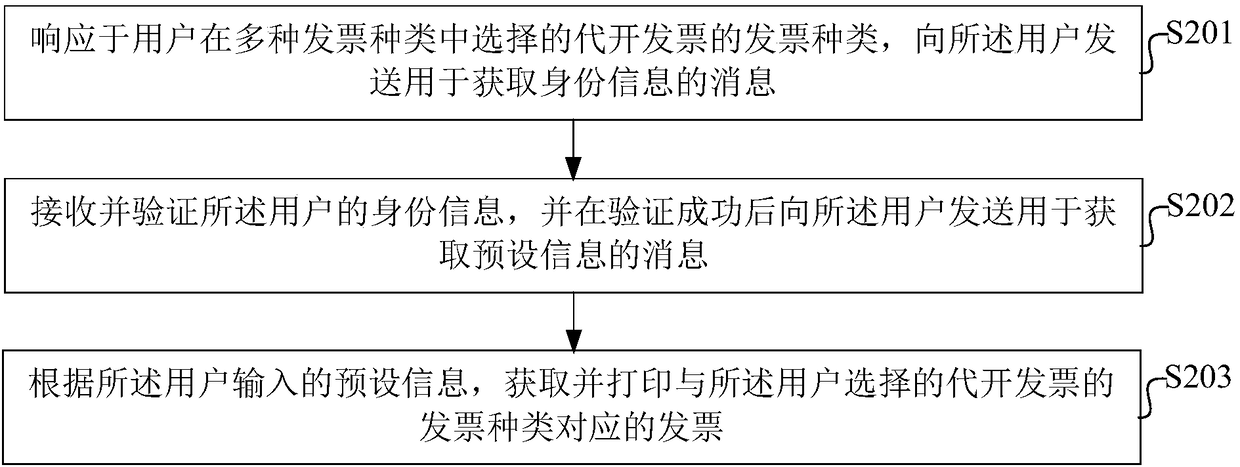

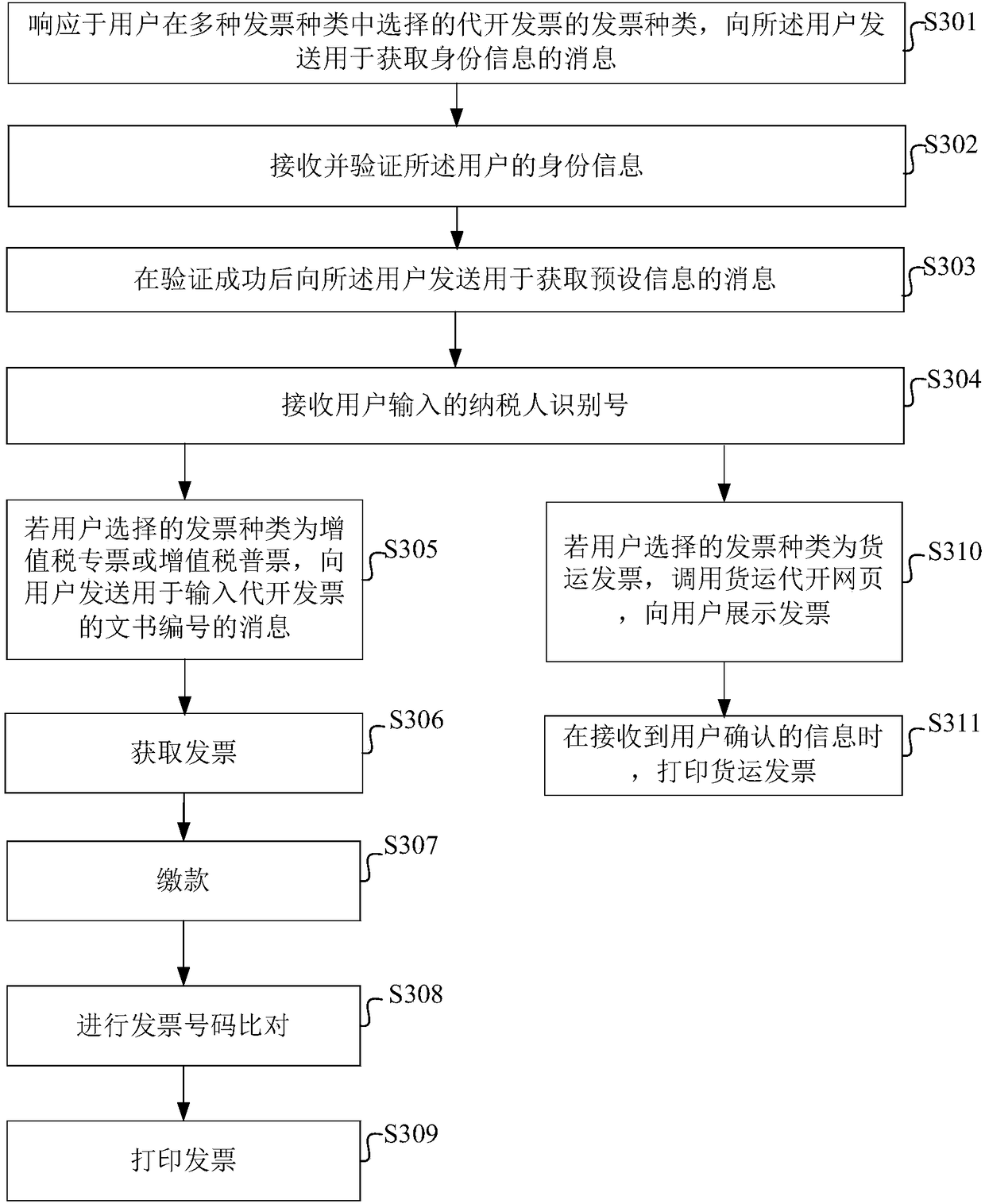

Method, device and system for issuing multiple invoices

The embodiment of the invention relates to a method, device and system for issuing multiple invoices. The method comprises the steps that in response to the invoice type of an issued invoice selectedby a user among a plurality of invoice types, a message used for acquiring identity information is sent to the user; the identity information of the user is received and verified, and a message used for acquiring preset information is sent to the user after the verification is successful; and according to the preset information input by the user, an invoice corresponding to the invoice type of theissued invoice selected by the user is acquired and printed. A taxpayer is allowed to make out a variety of invoices on an invoice issuing self-service terminal. The time to queue up at the window ofa tax service hall is saved for the user, and the time wasted by a traditional login method is saved. The pressure on the staff of the tax service hall is shared. The work efficiency is improved.

Owner:AEROSPACE INFORMATION

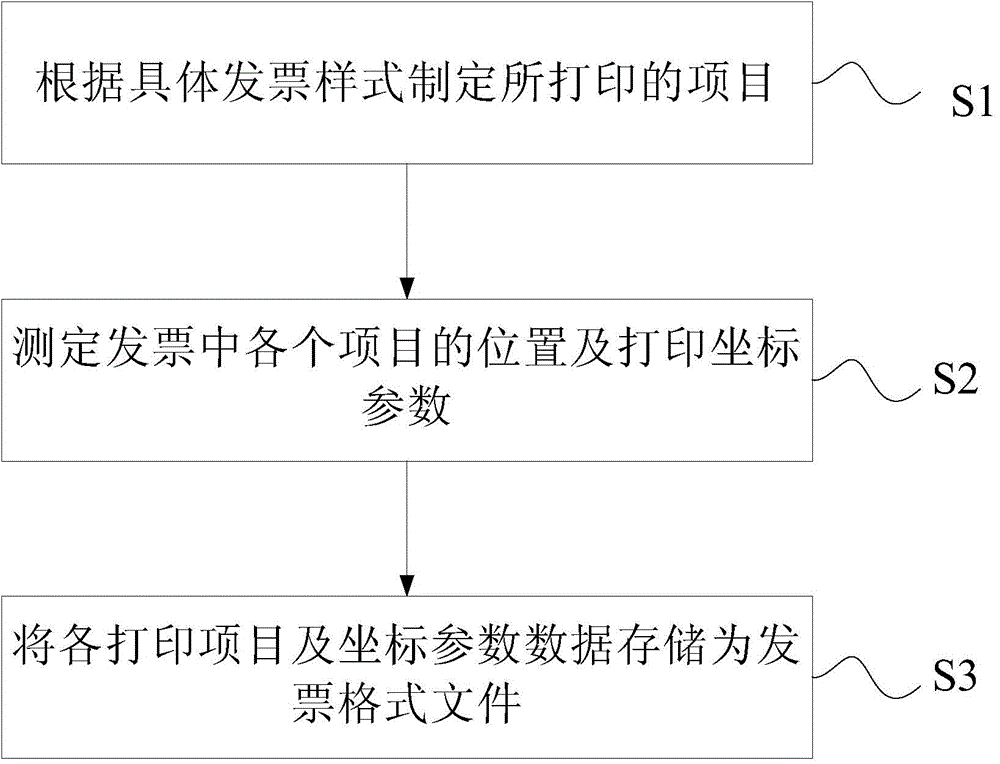

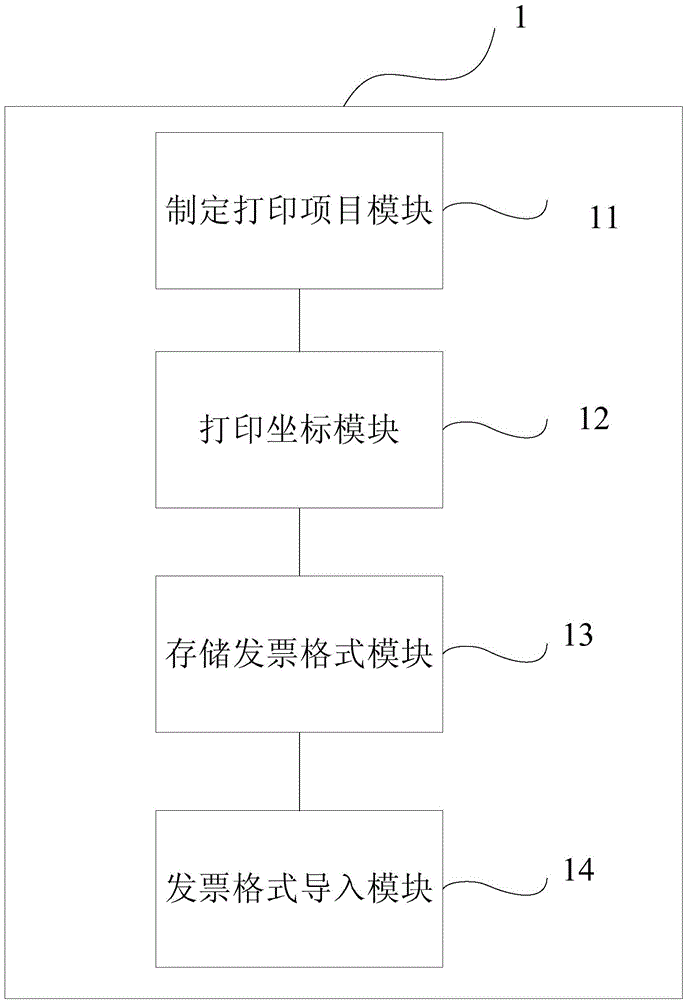

Method and system for rapidly setting invoice print format of fiscal cash register

The invention provides a method and a system for rapidly setting an invoice print format of a fiscal cash register. The method comprises the following steps of formulating to-be-printed items according to a specific invoice type; measuring the position of each item in an invoice and print coordinate parameters; storing each to-be-printed item and coordinate parameter data as an invoice format file. The to-be-printed items are formulated according to the invoice type, the position of each item in the invoice and the print coordinate parameters are determined, and each to-be-printed item and coordinate parameter data are stored as the invoice format file, so that invoices of different types can be conveniently and rapidly printed.

Owner:AEROSPACE INFORMATION

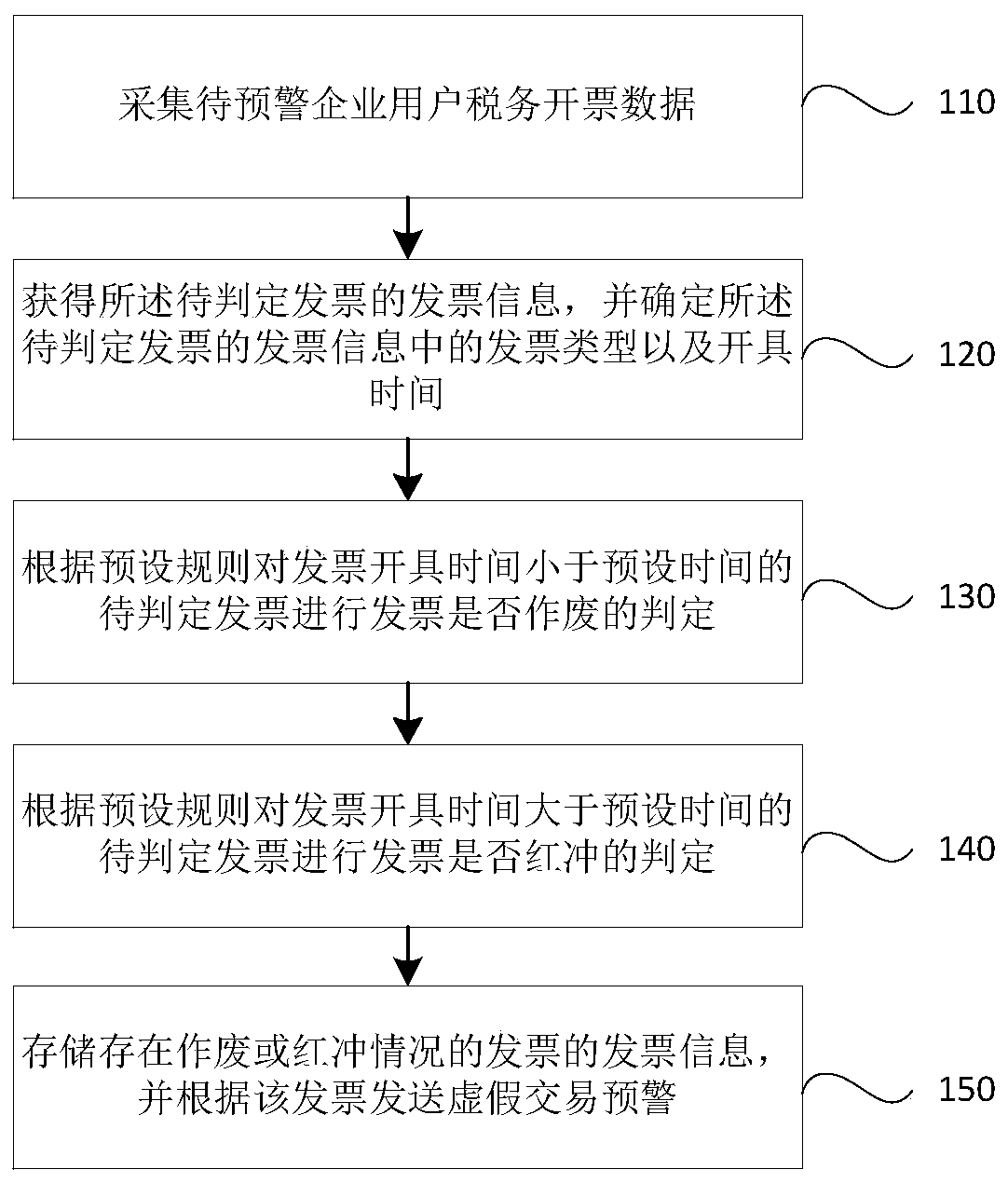

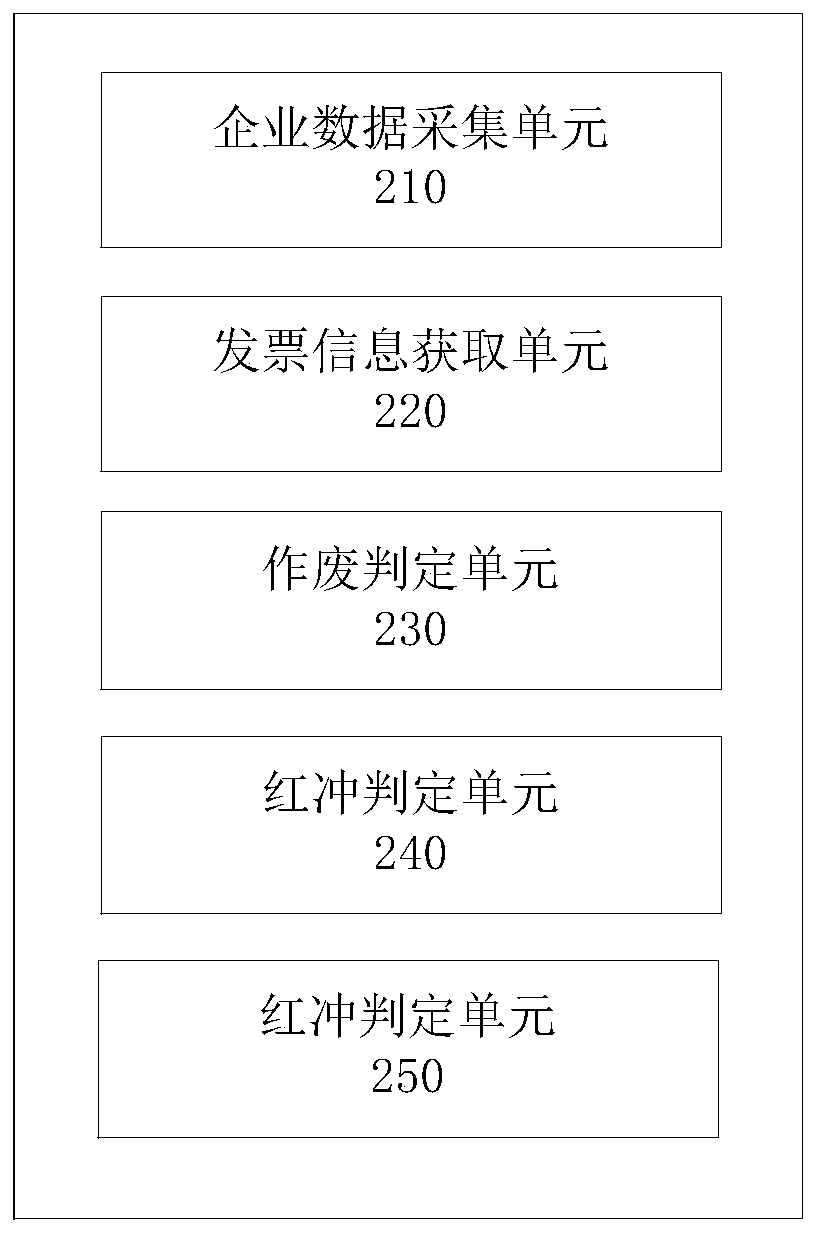

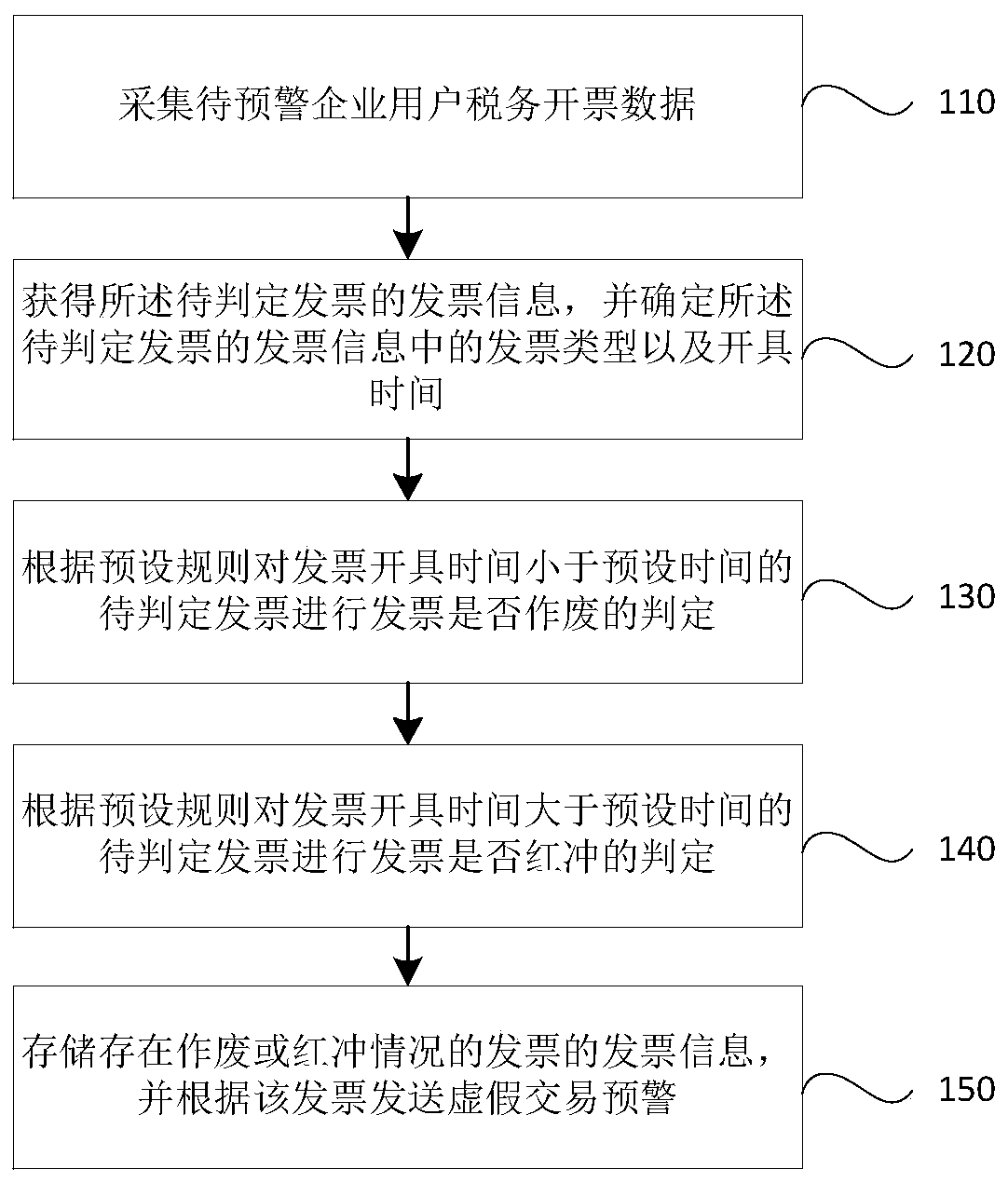

A false transaction early warning method and system based on invoice judgment

ActiveCN109840622AImprove verification efficiencyImprove accuracyFinanceForecastingInvoice typeComputer science

The invention discloses a false transaction early warning method and system based on invoice judgment. The method comprises the following steps: acquiring tax invoicing data of an enterprise user to be early warned; Obtaining invoice information of the to-be-judged invoice, and determining an invoice type and issuing time in the invoice information of the to-be-judged invoice; Judging whether theinvoice is discarded or not for the invoice to be judged with the invoice issuing time shorter than the preset time according to a preset rule; According to a preset rule, judging whether the invoiceis made red or not for the to-be-judged invoice with the invoice making time longer than the preset time; Storing the invoice information of the invoice with the discount or red note condition, and sending false transaction early warning according to the invoice; According to the method and the system, discarding and red-print behaviors of original invoices are used for discrimination, early warning is carried out in time, the false transaction checking efficiency is improved, and the false transaction identification accuracy is greatly improved.

Owner:AEROSPACE INFORMATION +1

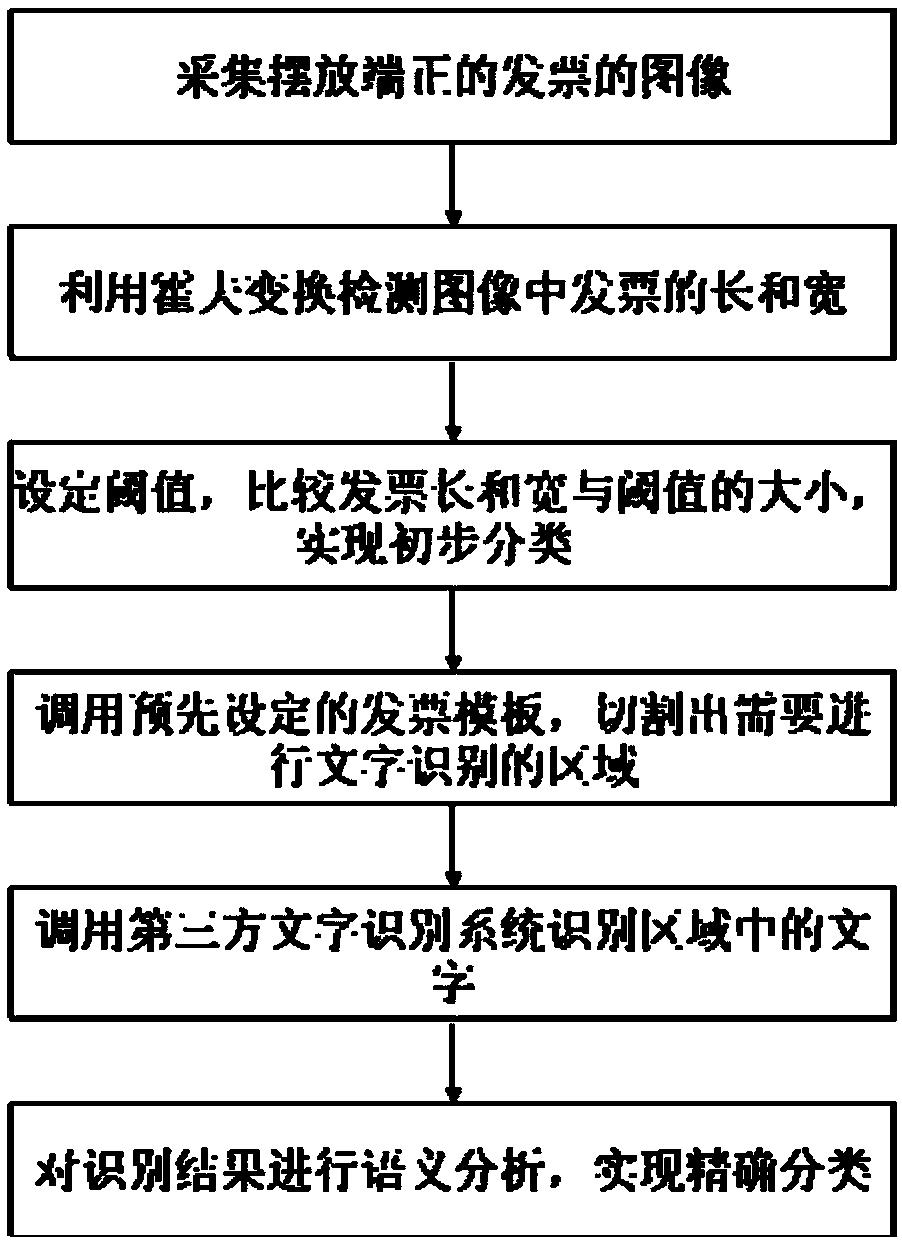

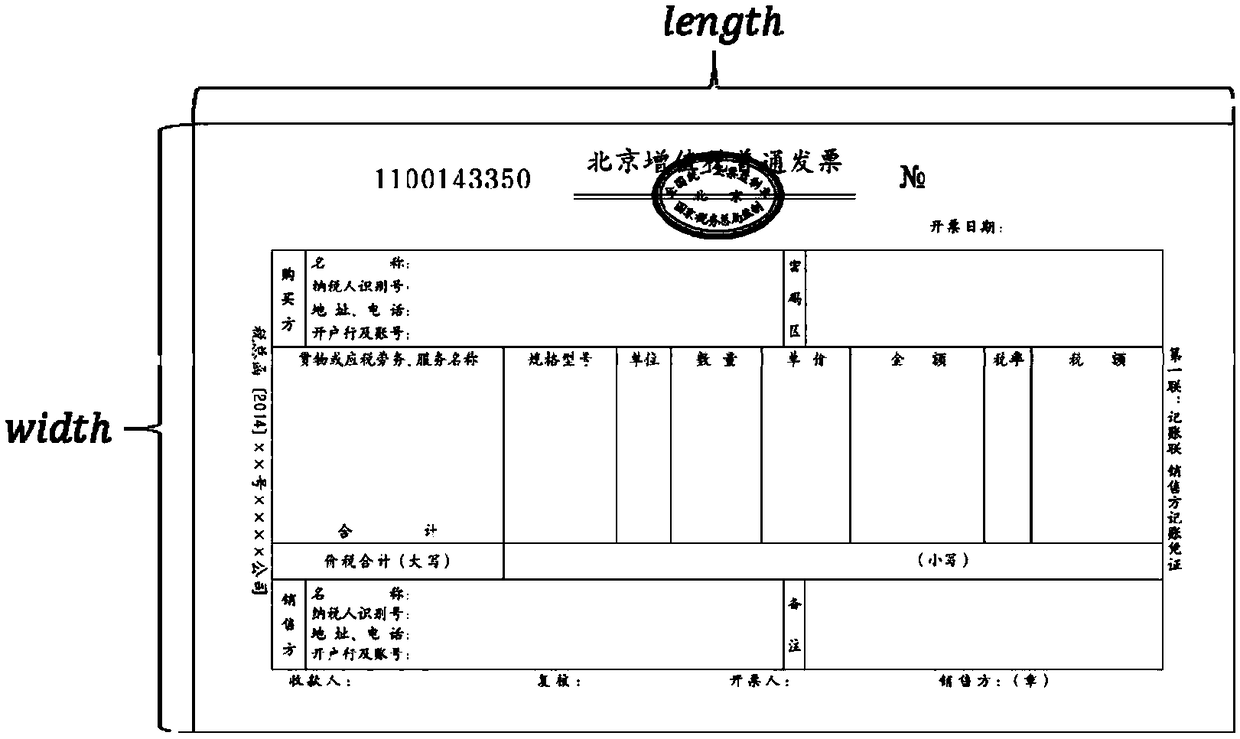

Invoice classification method based on character recognition and semantic analysis

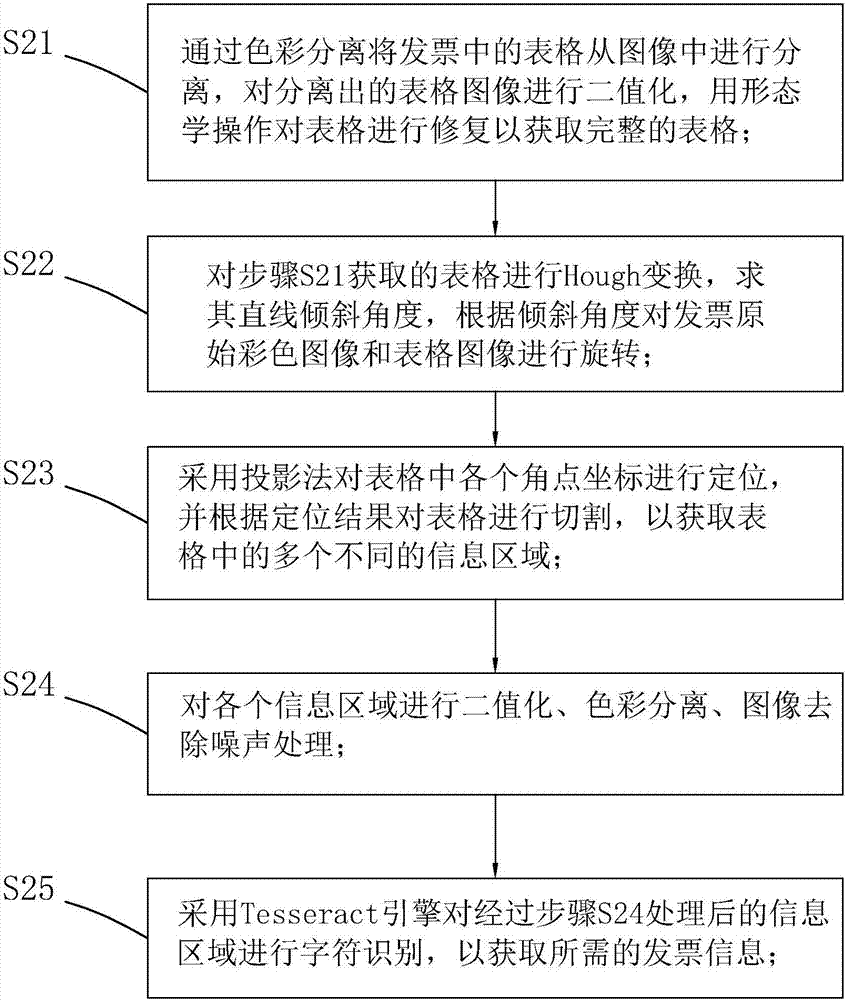

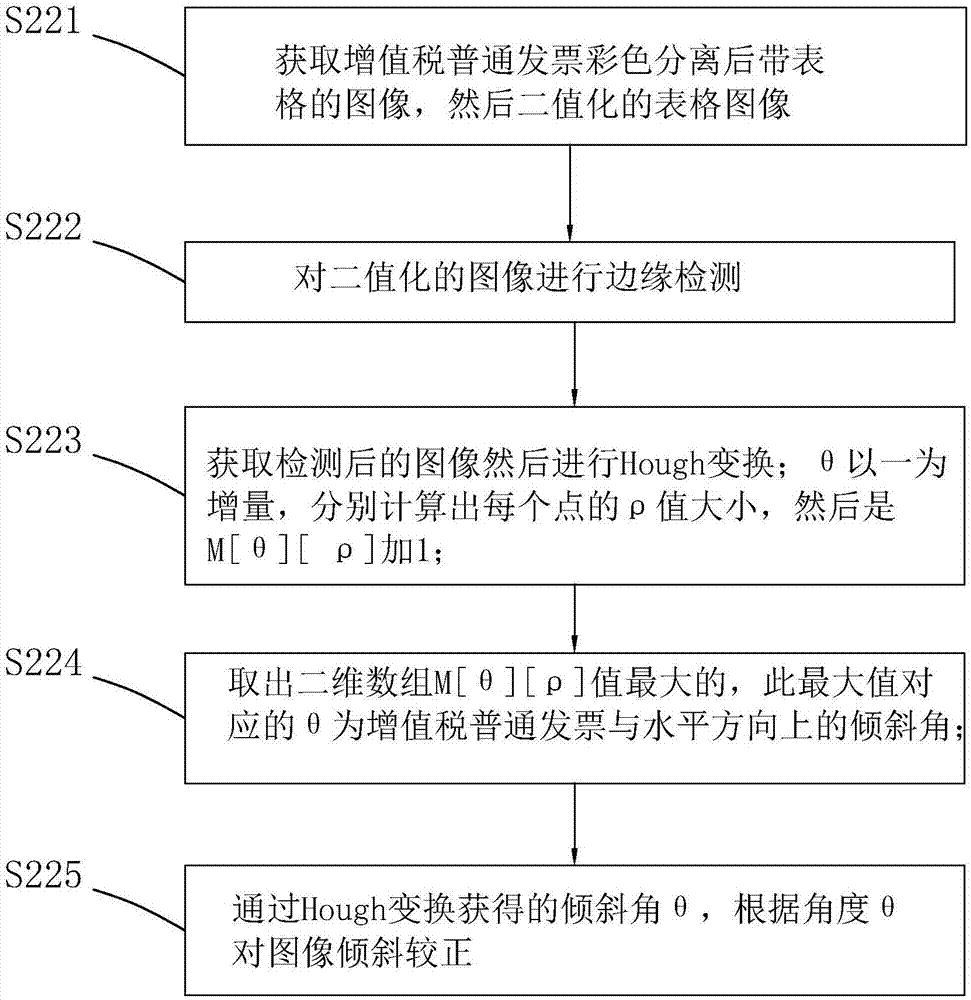

ActiveCN108460418AAccurate detectionImprove accuracyCharacter and pattern recognitionHough transformThird party

The invention discloses an invoice classification method based on character recognition and semantic analysis. The invention aims to detect the types of invoices. The method includes the following steps that: an image acquisition device is adopted to acquire an invoice image; the length and width of an invoice in the image are detected through Hough transform; the length and width are compared with preset thresholds, so that the preliminary classification of the invoice is realized; a corresponding invoice template is called according to a preliminary classification result, and a region wherecharacter recognition is needed is cut out; and a third-party character recognition system such as a Baidu recognition system is called to recognize characters in the above region; and after recognition is completed, semantic analysis is performed on a recognition result, and the accurate result of invoice classification is obtained. With the method of the invention adopted, a problem that accurate recognition cannot be realized in invoice recognition due to failure to classify an invoice type can be solved. The method is applicable to a plurality of different types of invoices, and has high application value in invoice recognition and smart financial reimbursement.

Owner:NANJING UNIV OF POSTS & TELECOMM

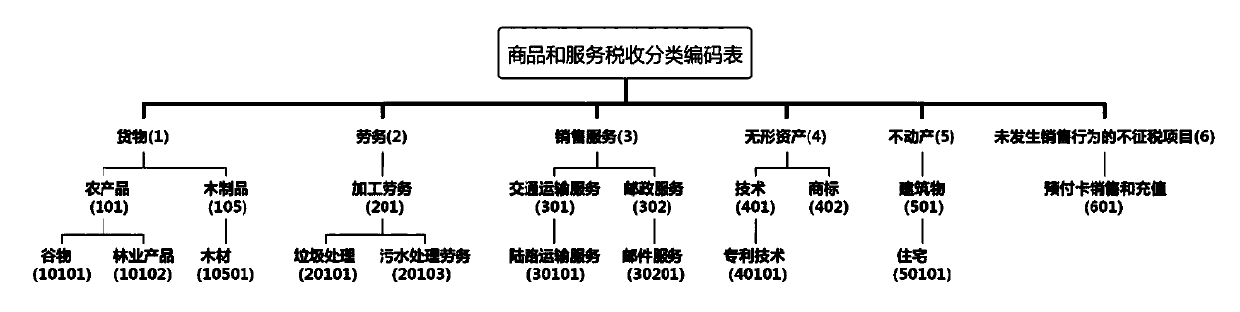

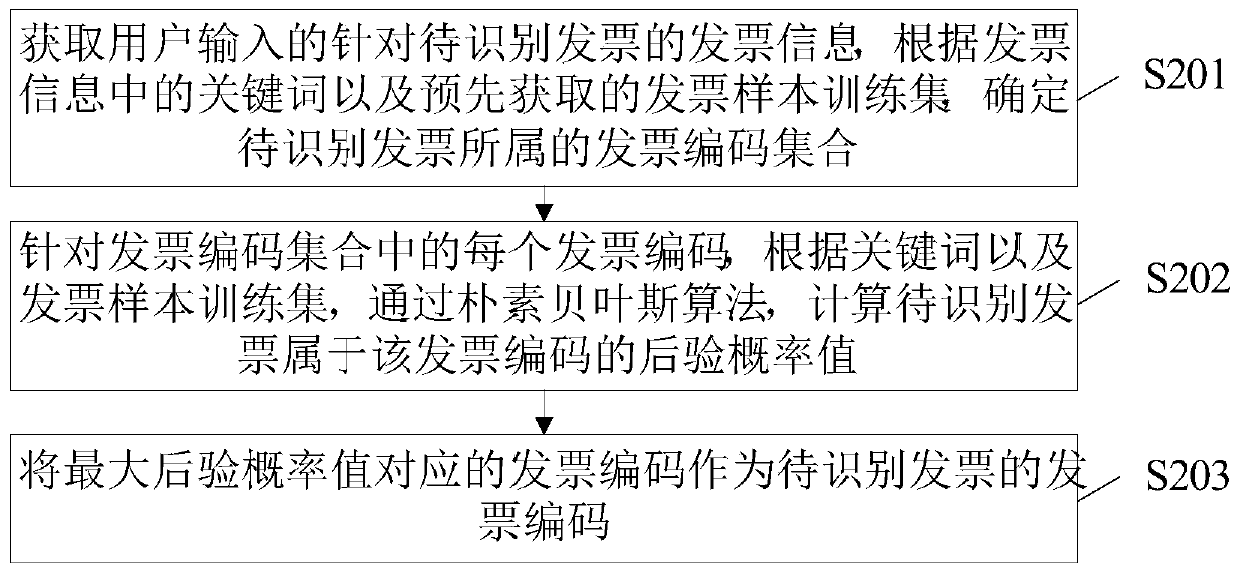

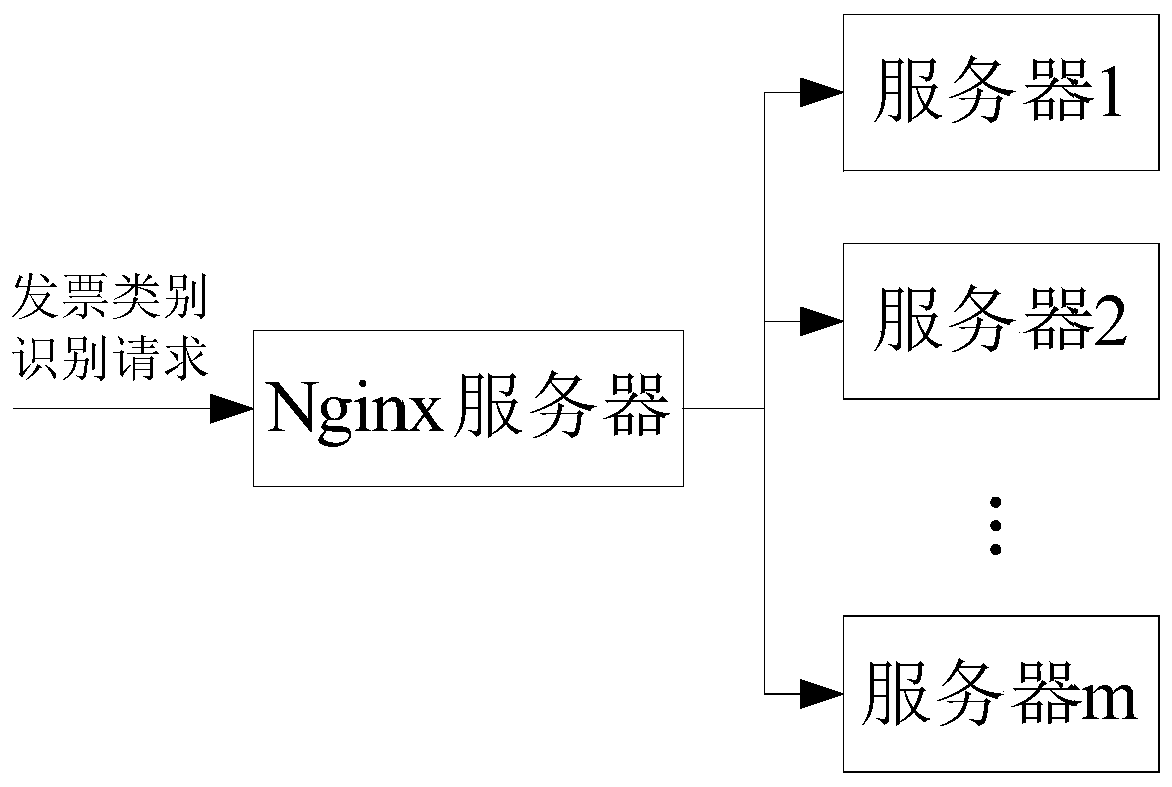

Invoice type identification method and device, electronic equipment and readable storage medium

ActiveCN110009796AImprove recognition efficiencyAccurate Coding ClassificationPaper-money testing devicesCharacter and pattern recognitionProgramming languageInvoice type

The embodiment of the invention provides an invoice category identification method and device, electronic equipment and a readable storage medium. The method is applied to the technical field of datamining and comprises the steps that invoice information input by a user and aiming at an invoice to be identified is acquired, and an invoice code set to which the invoice to be identified belongs isdetermined according to keywords in the invoice information and an invoice sample training set acquired in advance; for each invoice code in the invoice code set, calculating a posterior probability value of the invoice to be identified belonging to the invoice code through a naive Bayes algorithm according to the keyword and the invoice sample training set; and taking the invoice code corresponding to the maximum posterior probability value as the invoice code of the invoice to be identified. Compared with the prior art, the invoice type identification efficiency can be improved.

Owner:BEIJING UNIV OF POSTS & TELECOMM

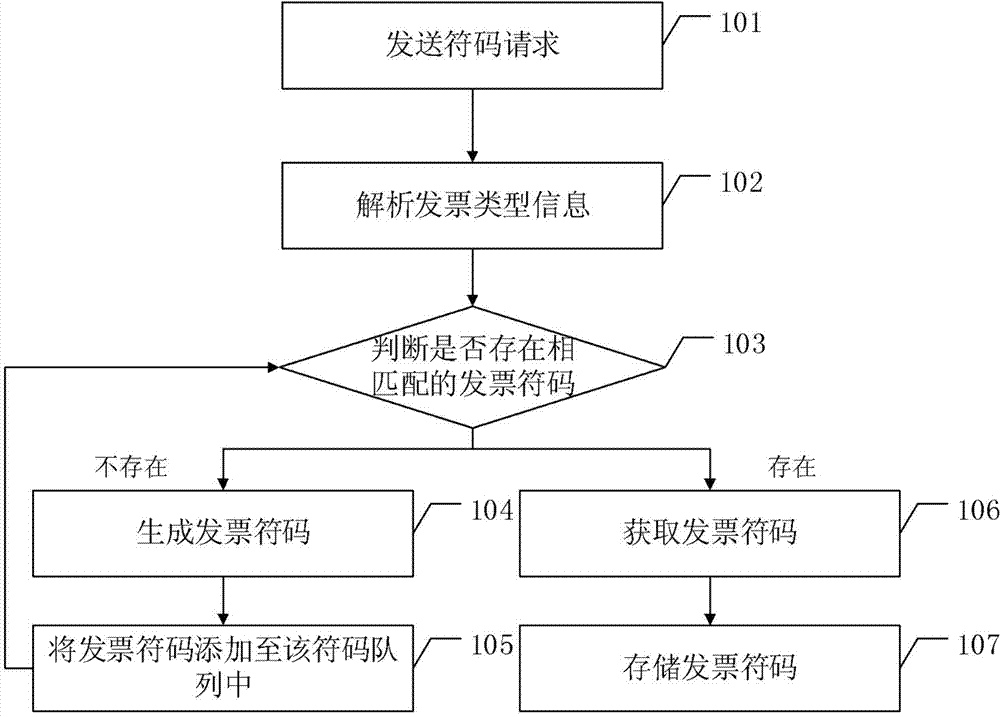

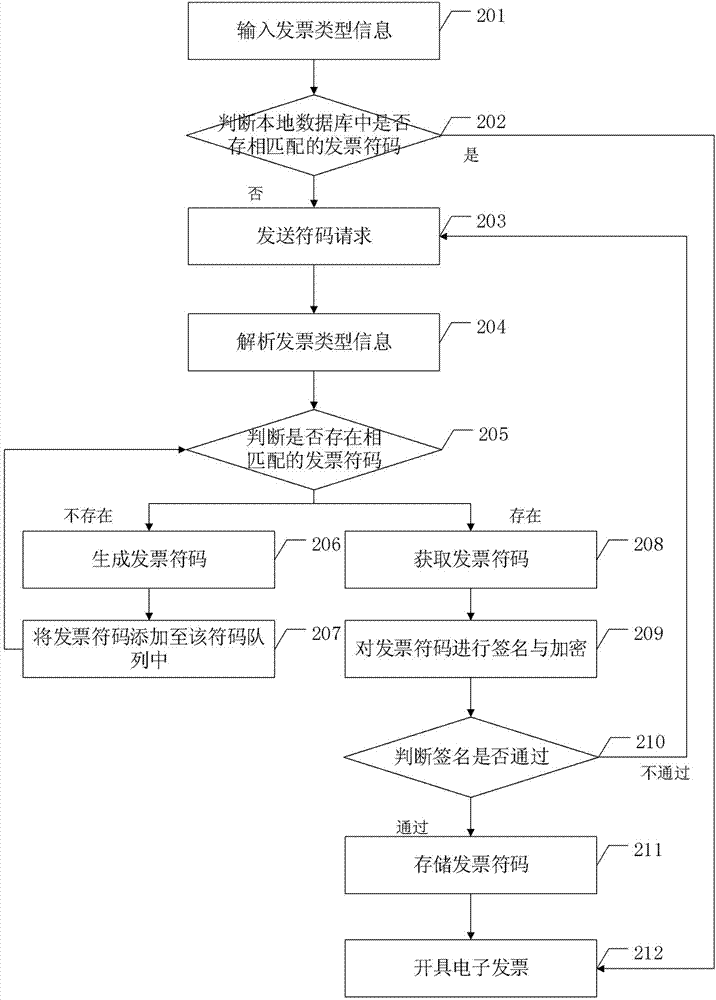

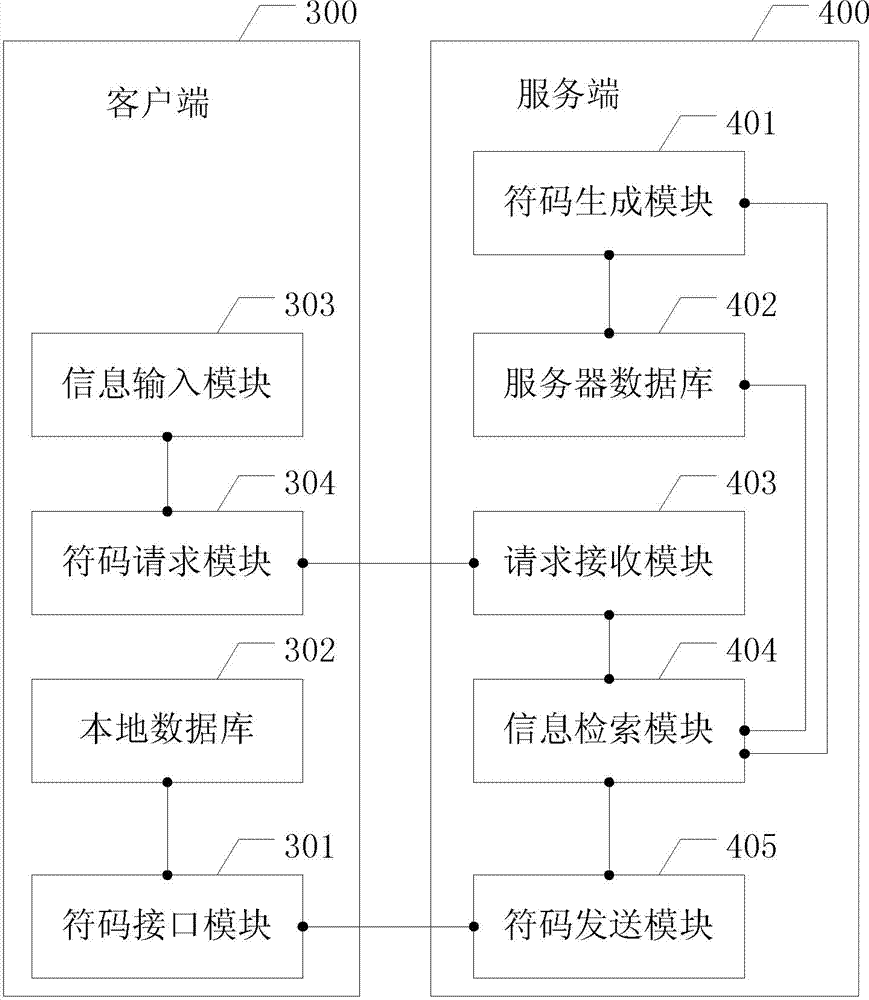

Electronic bill coding method and system

InactiveCN104851031AAdaptive strongImprove performanceBilling/invoicingSpecial data processing applicationsInvoice typeEngineering

The invention relates to the technical field of electronic invoices, specifically to an electronic bill coding method. The electronic bill coding method includes: sending a code request which contains invoice type information; retrieving a code queue in a server database according to the invoice type information in the code request; judging whether an invoice code matched with the invoice type information exists in the code queue, if an invoice code matched with the invoice type information does not exist, generating a matched invoice code according to the invoice type information, adding the invoice code to the code queue, and retrieving the code queue in the server database again; if an invoice code matched with the invoice type information exists, acquiring the invoice code; and storing the acquired invoice code to a local database. The electronic bill coding method provided by the invention has the advantages of strong adaptivity, high performance and adjustability, and provides convenience for popularization and application of electronic invoices.

Owner:深圳市中润四方信息技术有限公司

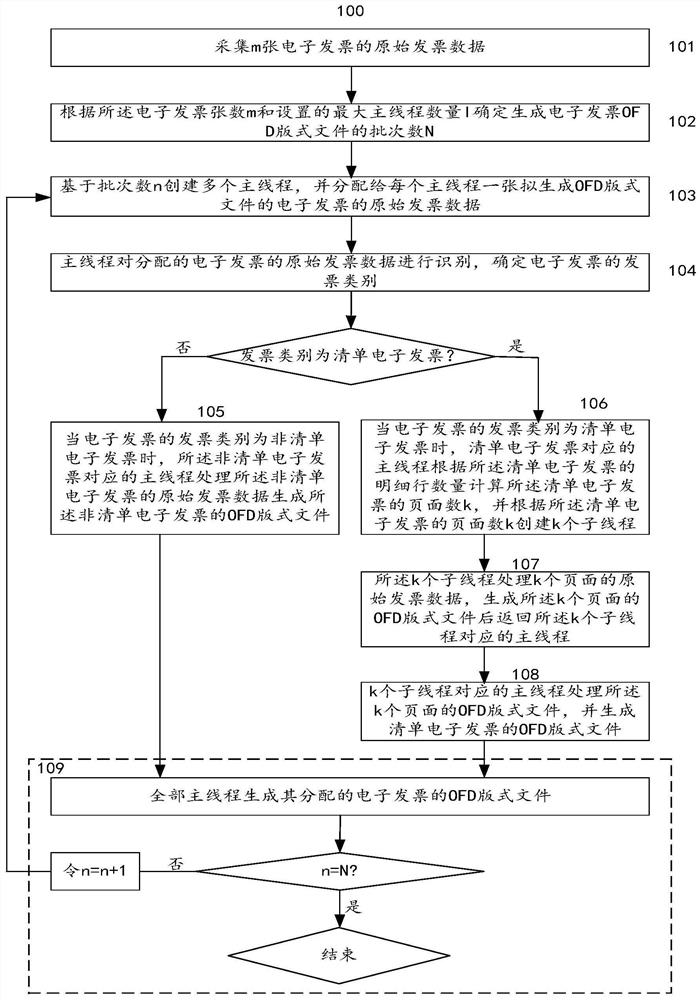

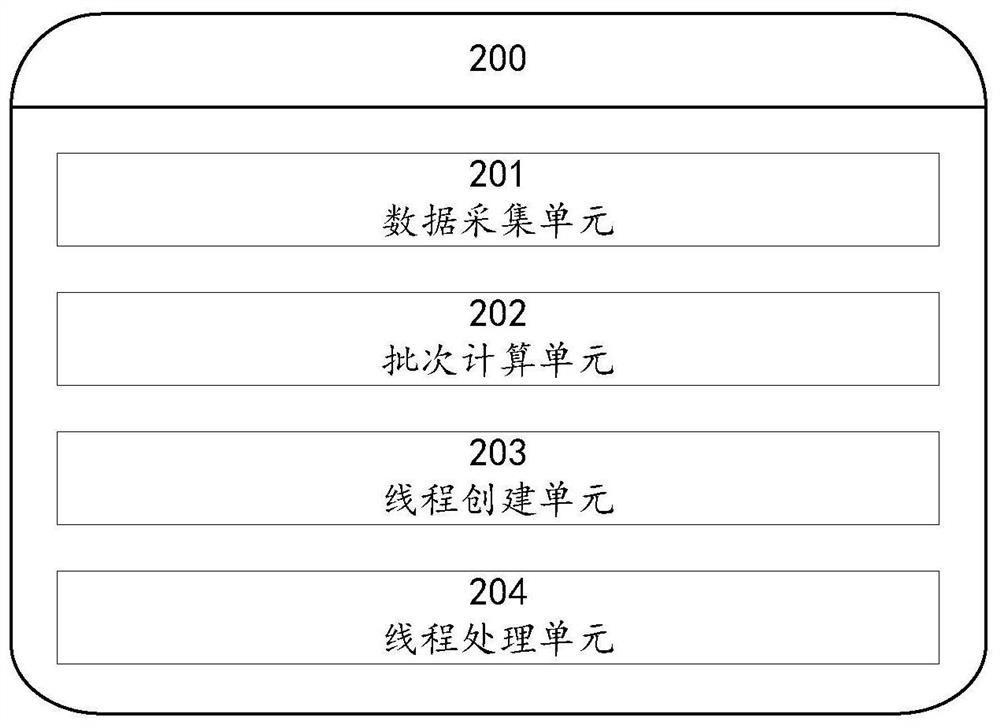

Method and system for parallelly generating OFD layout file of electronic invoice

PendingCN113327144AIncrease generation speedSave time and costResource allocationNatural language data processingInvoice typeGeneration process

The invention provides a method and a system for parallelly generating an OFD layout file of an electronic invoice. The method comprises the steps that the number of invoices in obtained original invoice data of electronic invoices is analyzed, the number of batches of electronic invoice OFD layout files needing to be generated is determined, a corresponding number of main threads are created for each batch, one electronic invoice is distributed to each main thread, the main threads recognize the electronic invoice data, and invoice types are determined; if the invoice is a list electronic invoice, the page number of the invoice is calculated and a sub-thread with the same page number is created, and a corresponding page of the list electronic invoice is processed in the sub-thread, and the processing result returns to the main thread, and an OFD layout file of the list electronic invoice is generated by the main thread; and after all the main threads are ended, the single-batch batch electronic invoice generation process is ended. According to the method and the system, batch parallel generation of the OFD layout files of the electronic invoices is realized, wherein the generation speed is improved, and the time cost is reduced.

Owner:AEROSPACE INFORMATION

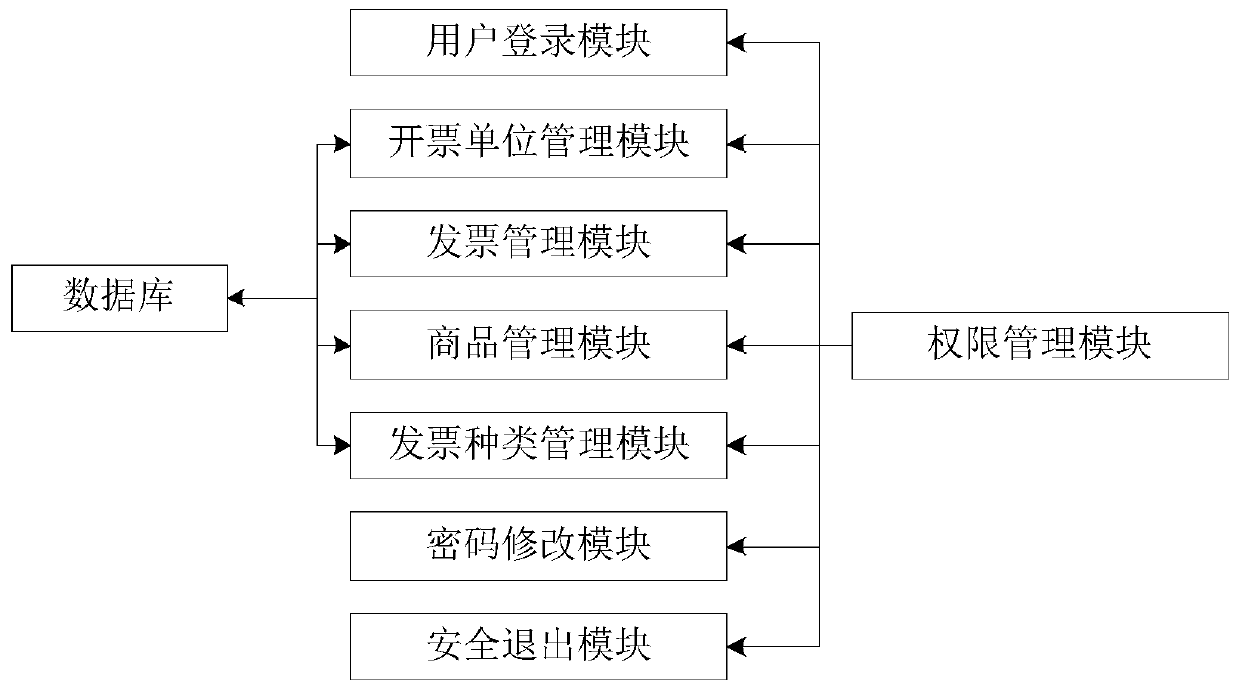

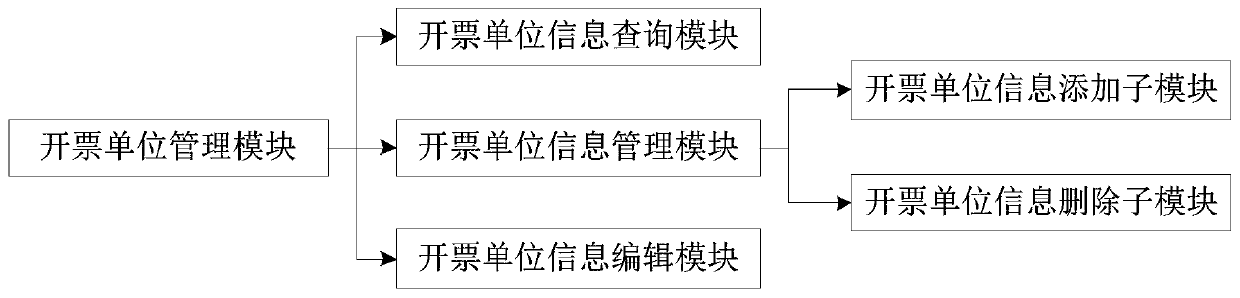

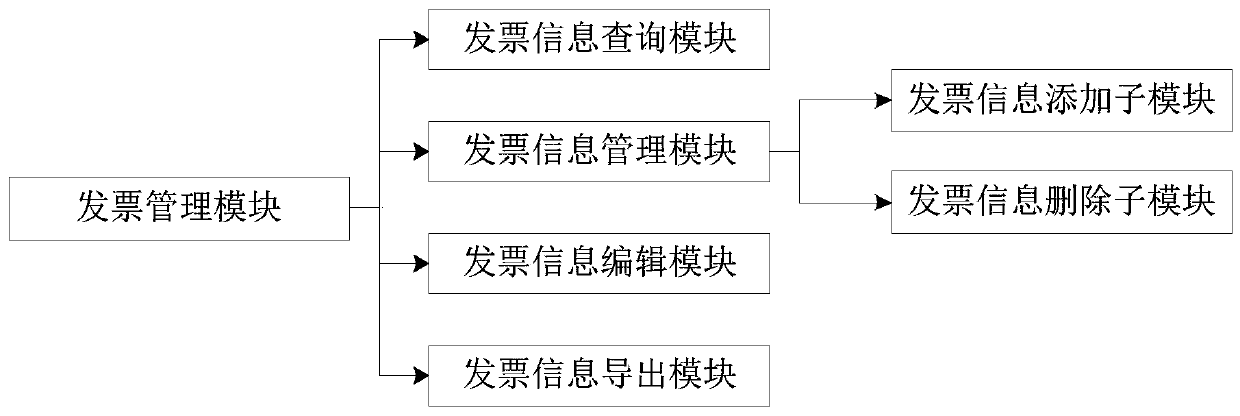

Electronic invoice reimbursement management system and method

ActiveCN110728567AOptimize the reimbursement processEasy to manageFinanceOffice automationInvoice typeManagement system

The invention relates to the technical field of electronic invoice management, and particularly relates to an electronic invoice reimbursement management system and method. The system is based on a method. The system comprises a server and a database. The server comprises the following modules: an invoicing unit management module, an invoice management module, a commodity management module, an invoice type management module and an authority management module, and the authority management module is used for respectively editing and managing all management targets under a menu management catalogue according to the formulated menu management catalogue. The management target comprises an authority management module, an invoicing unit management module, an invoice management module, a commoditymanagement module and an invoice type management module. Reimbursement management of electronic invoices can be optimized, the whole reimbursement process is public and transparent, and unified management and resource sharing of employees are facilitated.

Owner:重庆远见信息产业集团股份有限公司

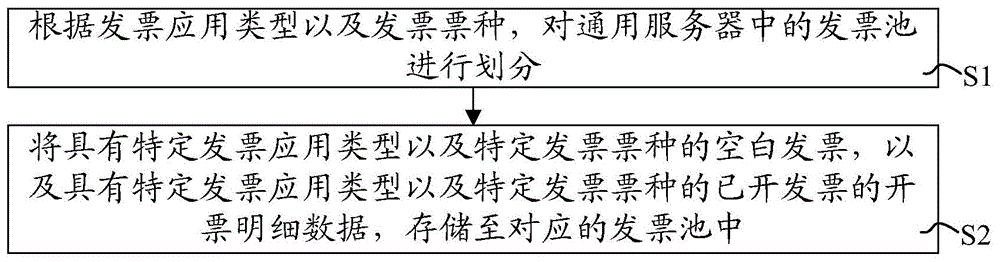

Method and system for storing tax-control data

InactiveCN106569749AEasy to manageShorten the timeInput/output to record carriersBilling/invoicingInvoice typeControl data

The invention discloses a method and system for storing tax-control data and relates to the field of computer technology application for improving the processing efficiency of invoicing transaction. The method for storing the tax-control data comprises the steps of (S1) dividing invoice pools in a universal server according to invoice application types and invoice types; and (S2) storing a blank invoice with a specific invoice application type and a specific invoice type, and invoicing detail data of an issued invoice with the specific invoice application type and the specific invoice type into corresponding pools. The method and the system are suitable for tax-control invoicing transaction.

Owner:百望金赋科技有限公司

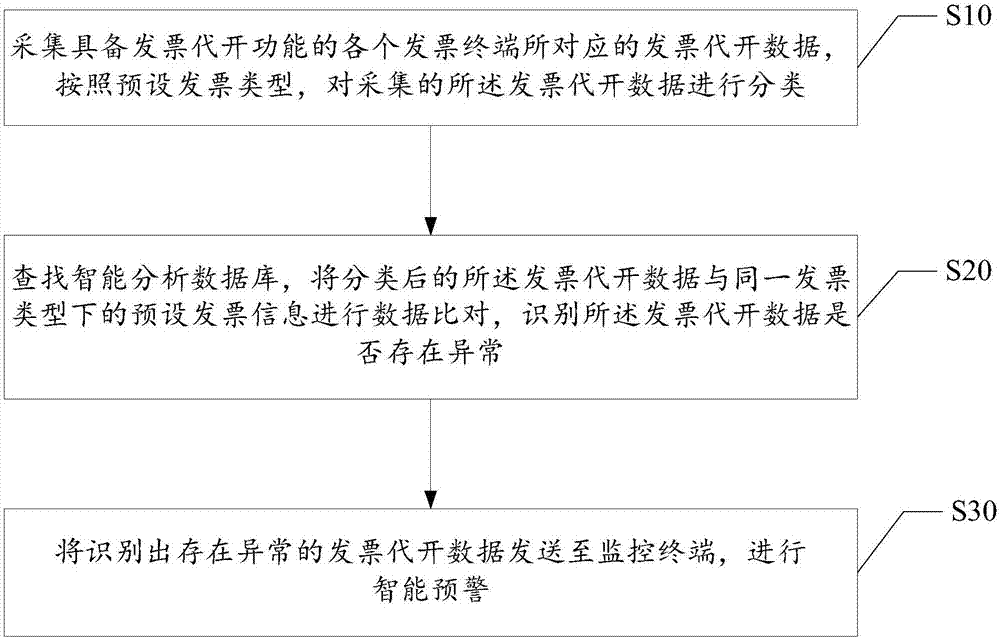

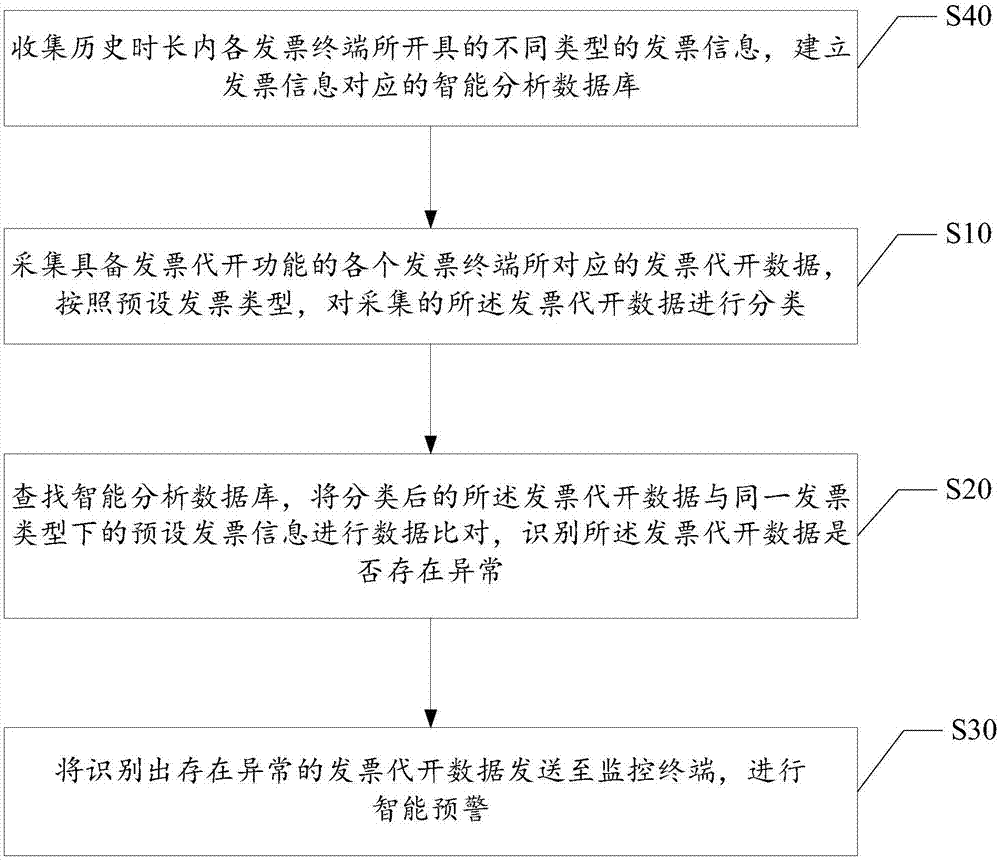

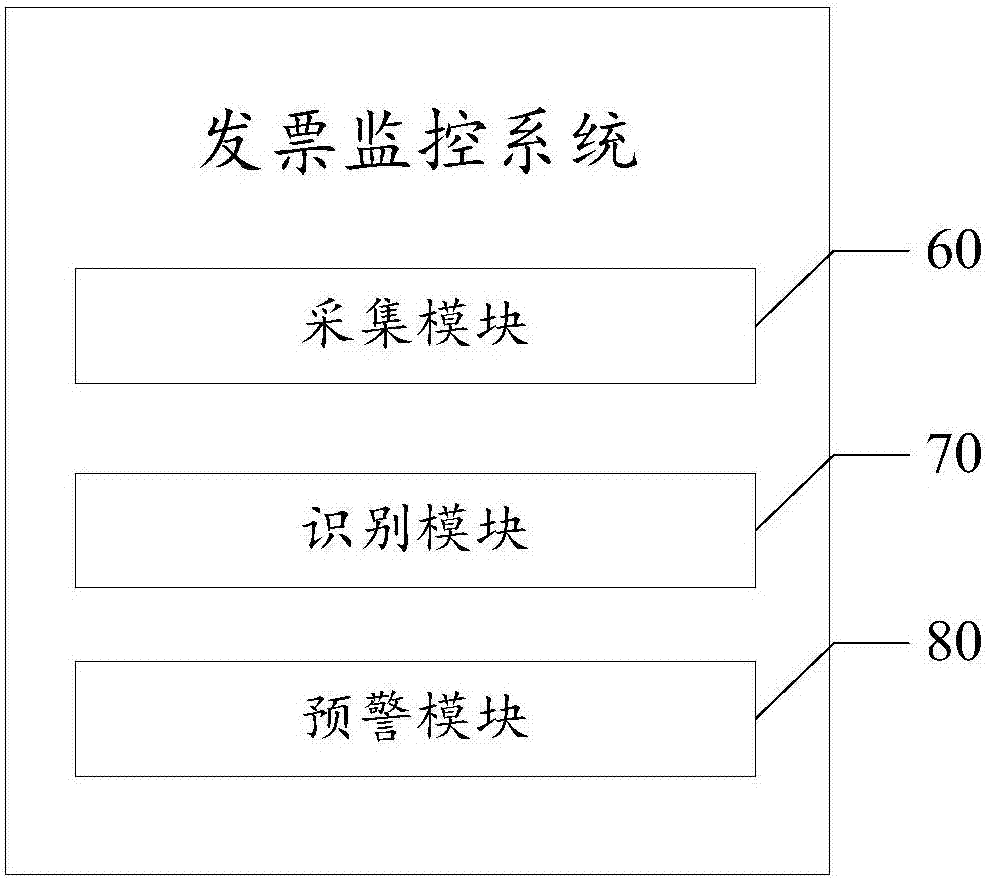

Invoice monitoring method and system

InactiveCN107358519AImprove monitoring efficiencyAvoid Transfer Pricing IssuesFinanceBilling/invoicingInvoice typeAnalysis data

The invention discloses an invoice monitoring method and system for automatically monitoring invoice information and intelligently giving early warning on monitored abnormal invoice information. The method includes: acquiring the invoicing data corresponding to each invoice terminal having an invoicing function, and classifying the acquired invoicing data according to a preset invoice type; searching in an intelligent analysis database, comparing the classified invoicing data with the preset invoice information in the same invoice type to identify whether the invoicing data is abnormal; and sending the identified abnormal invoicing data to a monitoring terminal for intelligent early warning. The invoice monitoring method and system are capable of automatically monitoring invoice information and intelligently giving early warning on the monitored abnormal invoice information, and improves the efficiency of monitoring the invoice data.

Owner:新疆航天信息有限公司

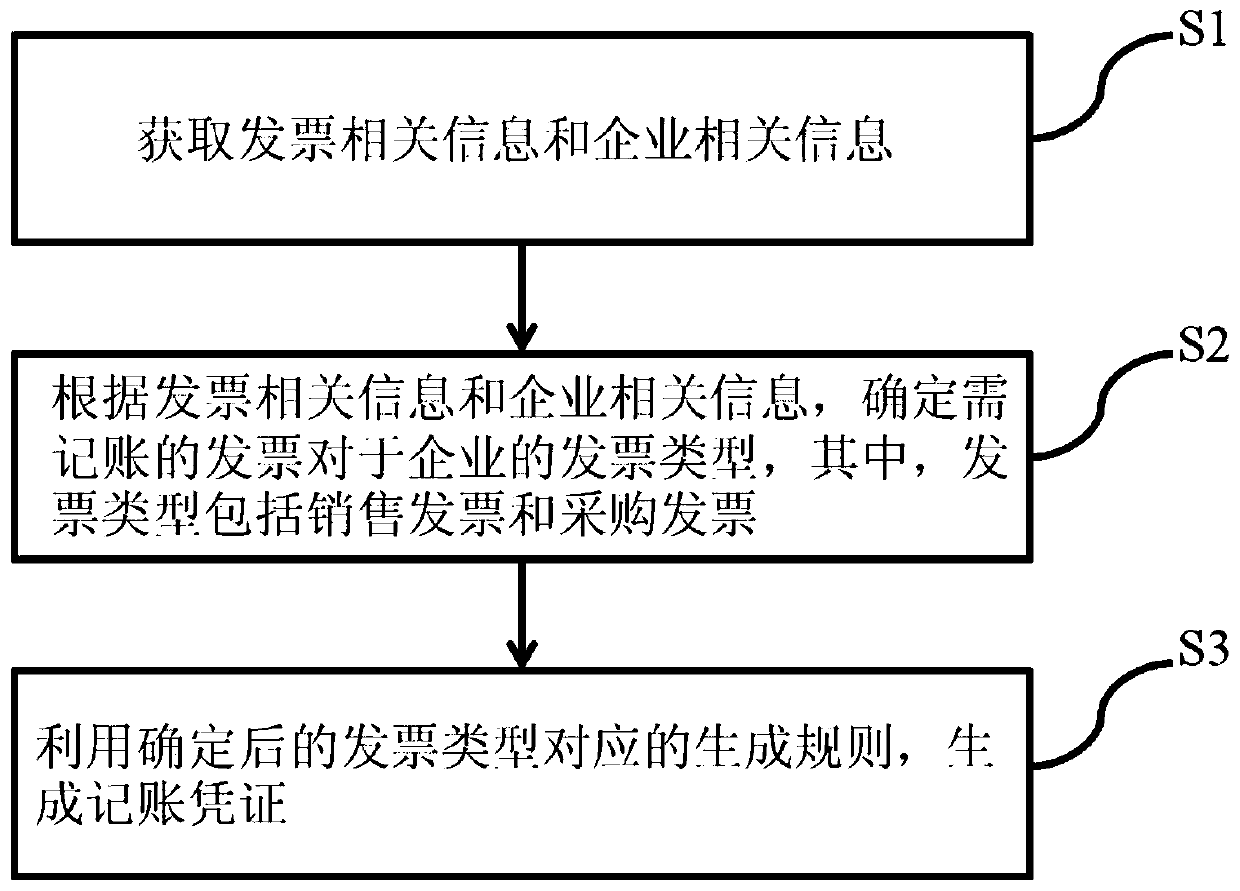

Accounting voucher generation method and device and computer storage medium

InactiveCN109859021AIncrease productivitySolve the problems of manual bookkeepingFinanceInvoice typePurchase invoice

The invention relates to an accounting voucher generation method and device and a computer storage medium. The accounting voucher generation method comprises: acquiring invoice related information andenterprise related information; according to the invoice related information and the enterprise related information, determining the invoice type of the invoice needing accounting for the enterprise,wherein the invoice type comprises a sale invoice and a purchase invoice; and generating an accounting voucher by using the generation rule corresponding to the determined invoice type. By means of the technical scheme, the accounting voucher can be automatically generated, so that the problems existing in manual accounting in the prior art are solved, enterprise accounting gets rid of the current situation of relying on manual processing, the labor cost is saved, and the production efficiency of the accounting industry is improved.

Owner:北京轻赢数据科技有限公司

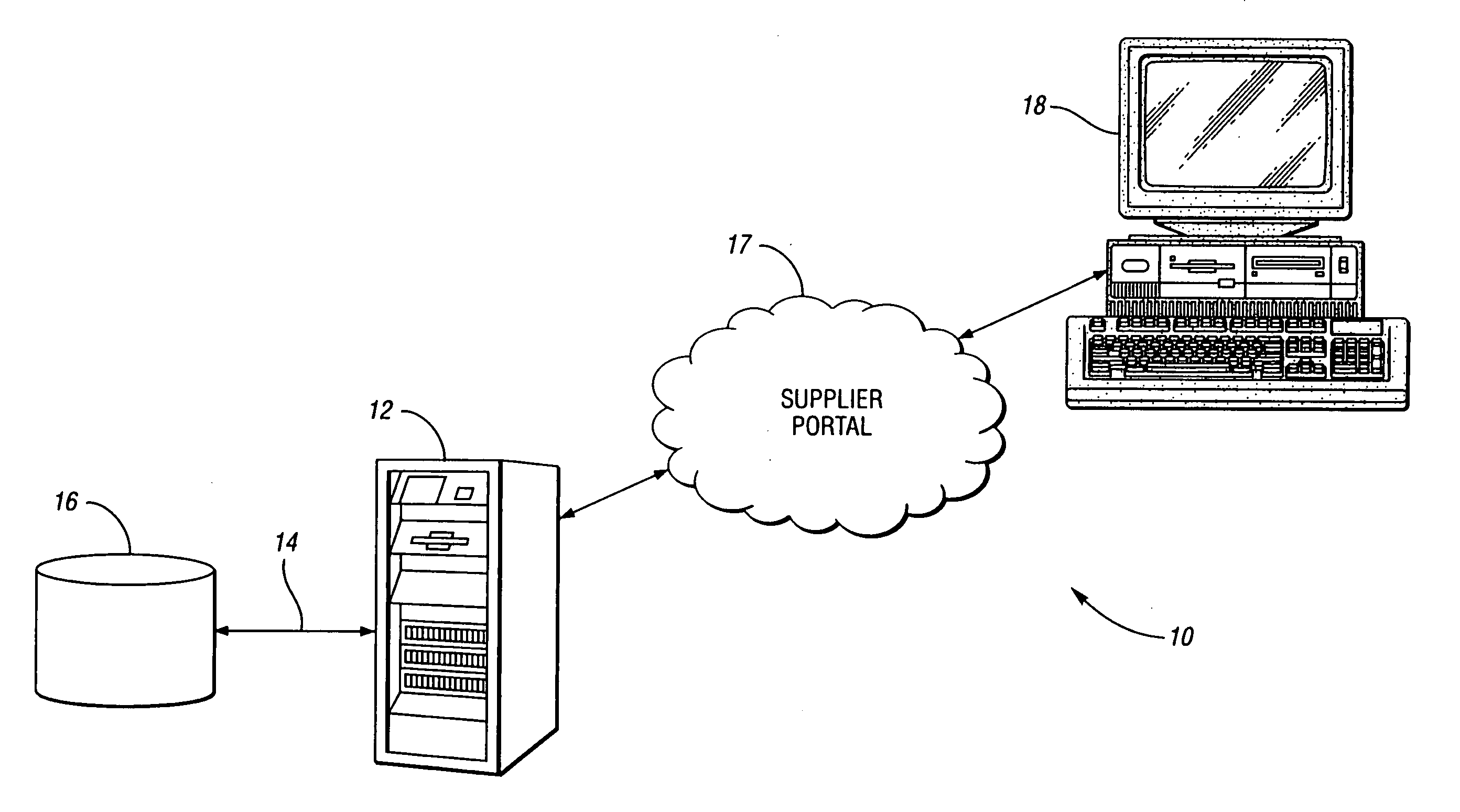

Computer-implemented method and system for grouping receipts

A computer-implemented method for summarizing receipts and grouping the receipts onto one or more invoices. The method includes receiving a number of receipts and a time period including a start date and an end date, summarizing the receipts in the number of receipts having an approval date in the time period to obtain a number of summarized receipts, and grouping the summarized receipts to obtain one or more grouped invoices based on two of a number of grouping rules, the number of grouping rules including grouping by supplier pay site code, grouping by payment currency, grouping by receipt number, to grouping by payment term, grouping by value date, grouping by invoice type, and grouping by tax rules.

Owner:FORD MOTOR CO

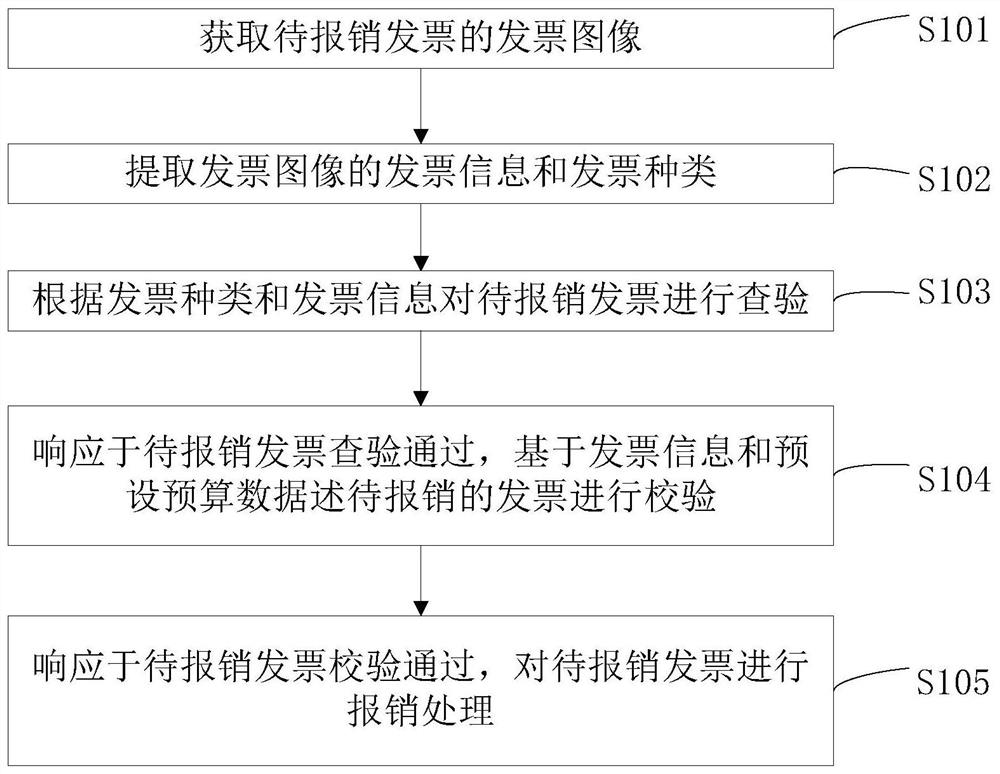

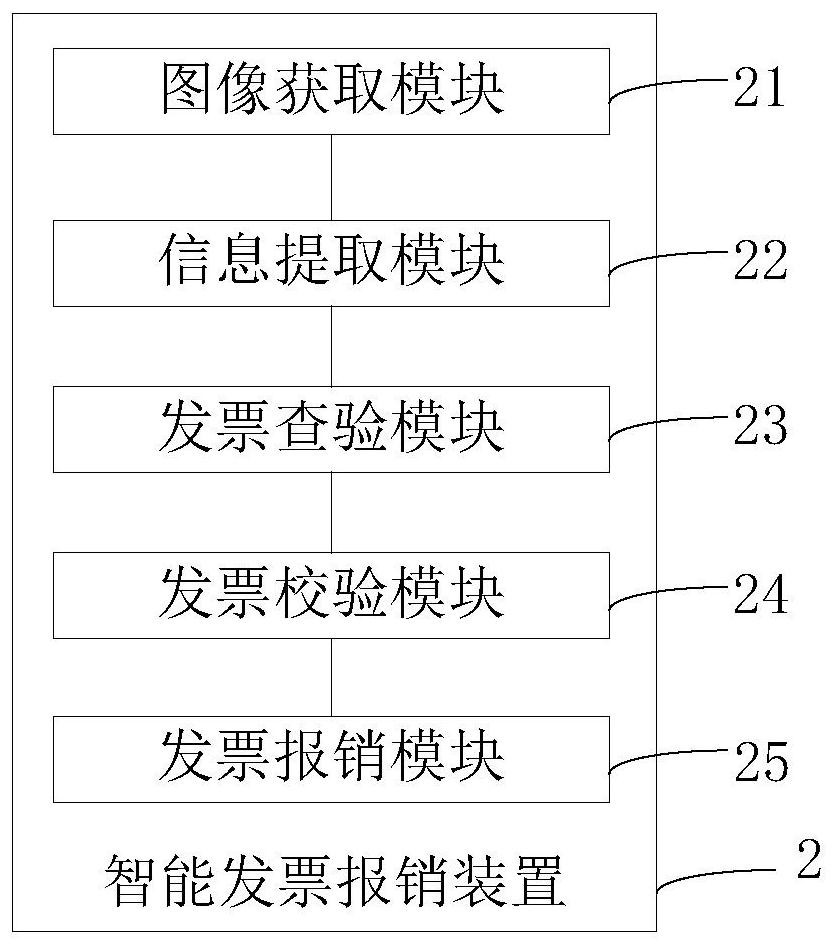

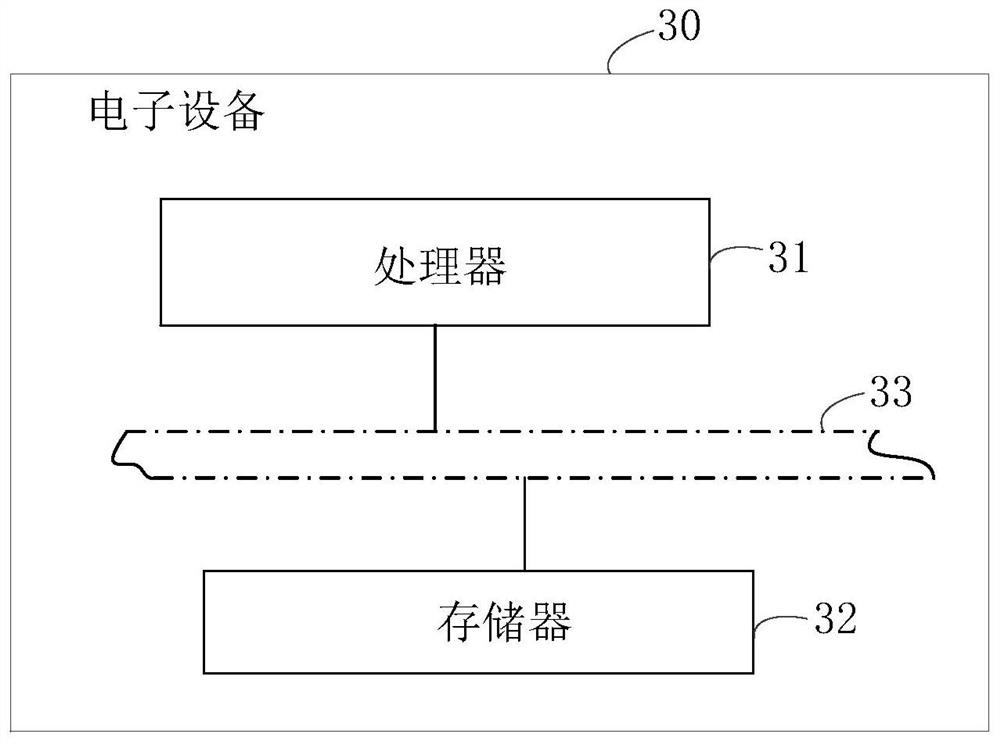

Intelligent invoice reimbursement method and device, electronic equipment and computer storage medium

PendingCN113379526AImprove the efficiency of reimbursementImprove efficiencyFinanceCharacter and pattern recognitionInvoice typeData science

The invention discloses an intelligent invoice reimbursement method and apparatus, electronic equipment and a computer storage medium. The method comprises the steps of obtaining an invoice image of a to-be-reimbursed invoice; extracting the invoice information and invoice type of the invoice image; checking the invoice to be reimbursed according to the invoice type and the invoice information; verifying the invoice to be reimbursed based on the invoice information and preset budget data in response to the fact that the invoice to be reimbursed passes checking; and in response to fact that the to-be-reimbursed invoice passes verification, performing reimbursement processing on the invoice to be reimbursed. According to the invention, automatic reimbursement is realized, manpower and material resources are saved, and the efficiency of invoice reimbursement is improved.

Owner:STATE GRID LIAONING ELECTRIC POWER CO LTD SHENYANG POWER +2

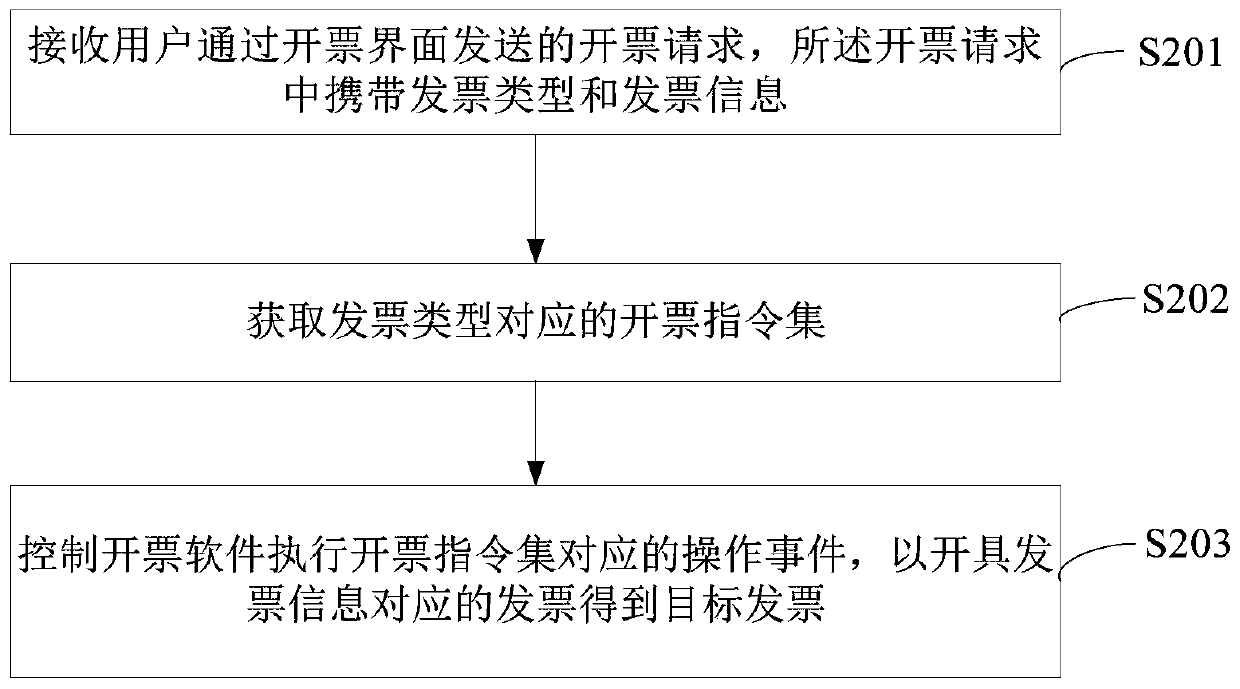

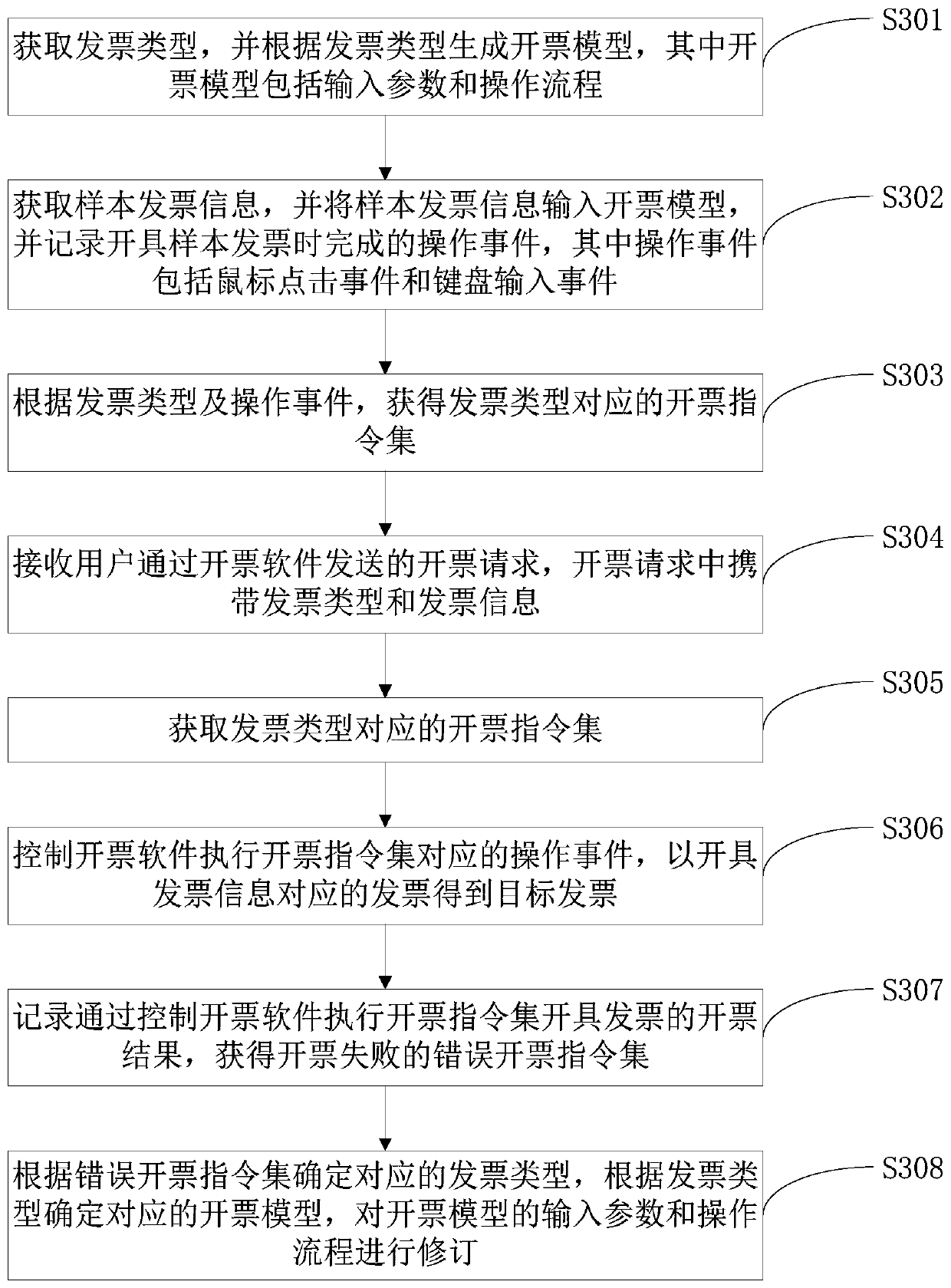

Invoice issuing method and equipment

The embodiment of the invention provides an invoice issuing method and equipment. The method comprises the steps that an invoicing request sent by a user through an invoicing interface is received, the invoicing request carries an invoice type and invoice information, an invoicing instruction set corresponding to the invoice type is acquired, and invoicing software is controlled to execute an operation event corresponding to the invoicing instruction set to issue an invoice corresponding to the invoice information to obtain a target invoice. According to the embodiment of the invention, the invoicing software is controlled to automatically execute the specific operation process and the input parameters of invoicing and generate the target invoice, so that the human resource investment is saved, the invoicing accuracy is improved, the error probability is reduced, and the tax risk of an enterprise is reduced.

Owner:上海云砺信息科技有限公司

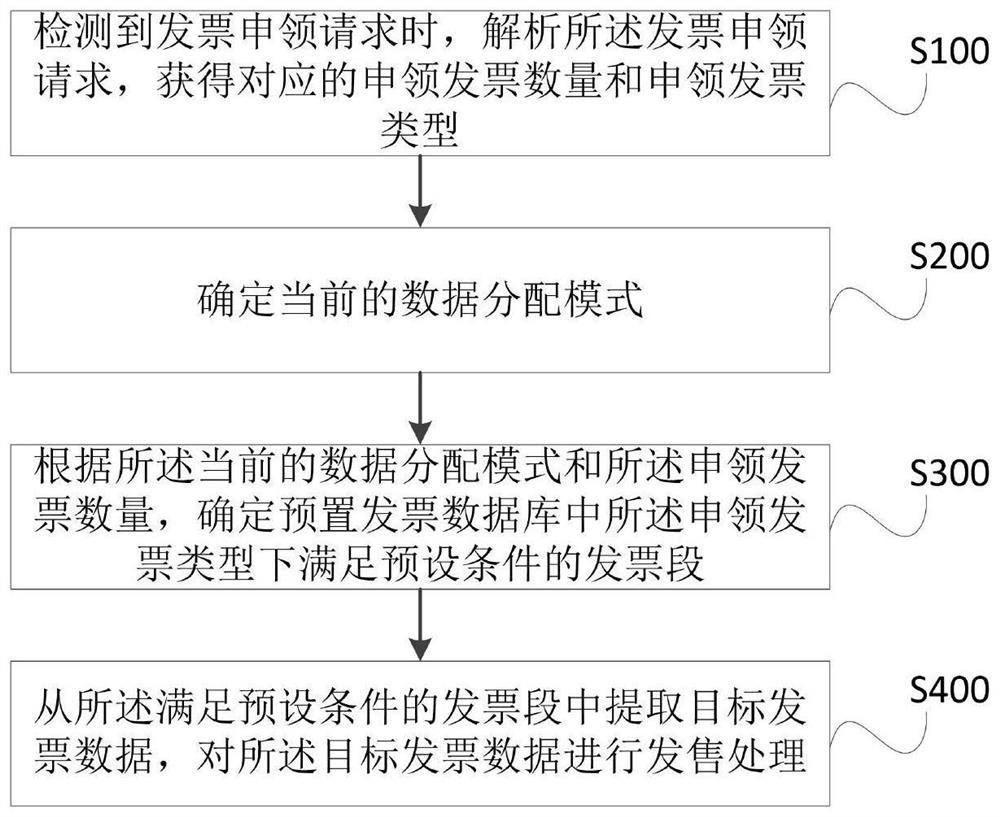

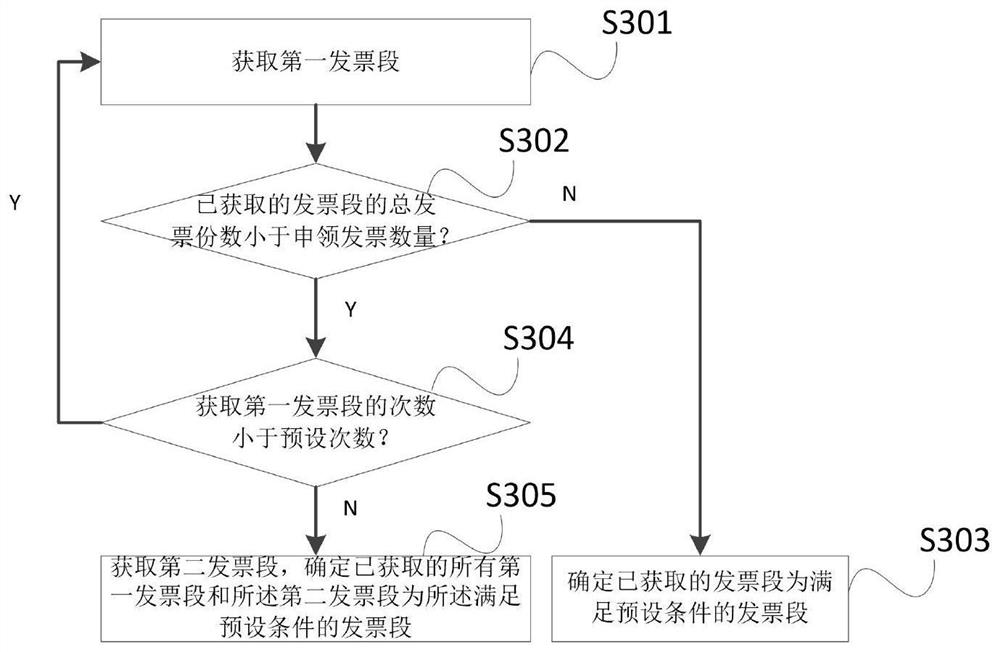

Invoice data processing method and device, computer equipment and storage medium

The invention provides an invoice data processing method and device, computer equipment and a storage medium. The invoice data processing method comprises the following steps: when an invoice claimingrequest is detected, analyzing the invoice claiming request to obtain a corresponding claiming invoice quantity and a claiming invoice type; determining a current data distribution mode; according tothe current data distribution mode and the number of the applied invoices, determining invoice sections meeting preset conditions under the type of the applied invoices in a preset invoice database;when the current data distribution mode is a first mode, determining that the invoice segments meeting the preset conditions comprise the first preset number of invoice segments with the minimum invoice number; and extracting target invoice data from the invoice segments meeting the preset conditions, and selling the target invoice data. The data storage pressure of the invoice database can be reduced.

Owner:安徽航天信息有限公司

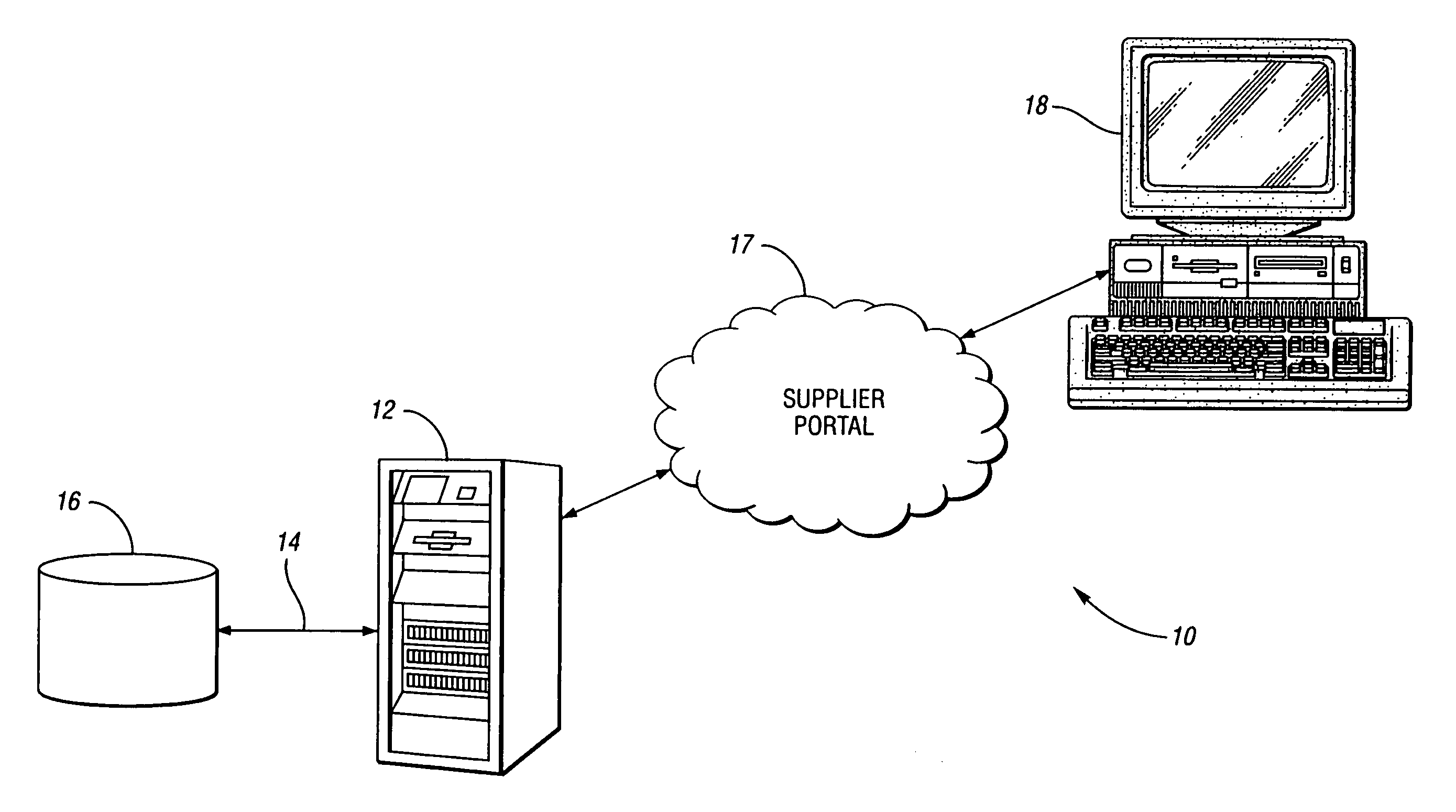

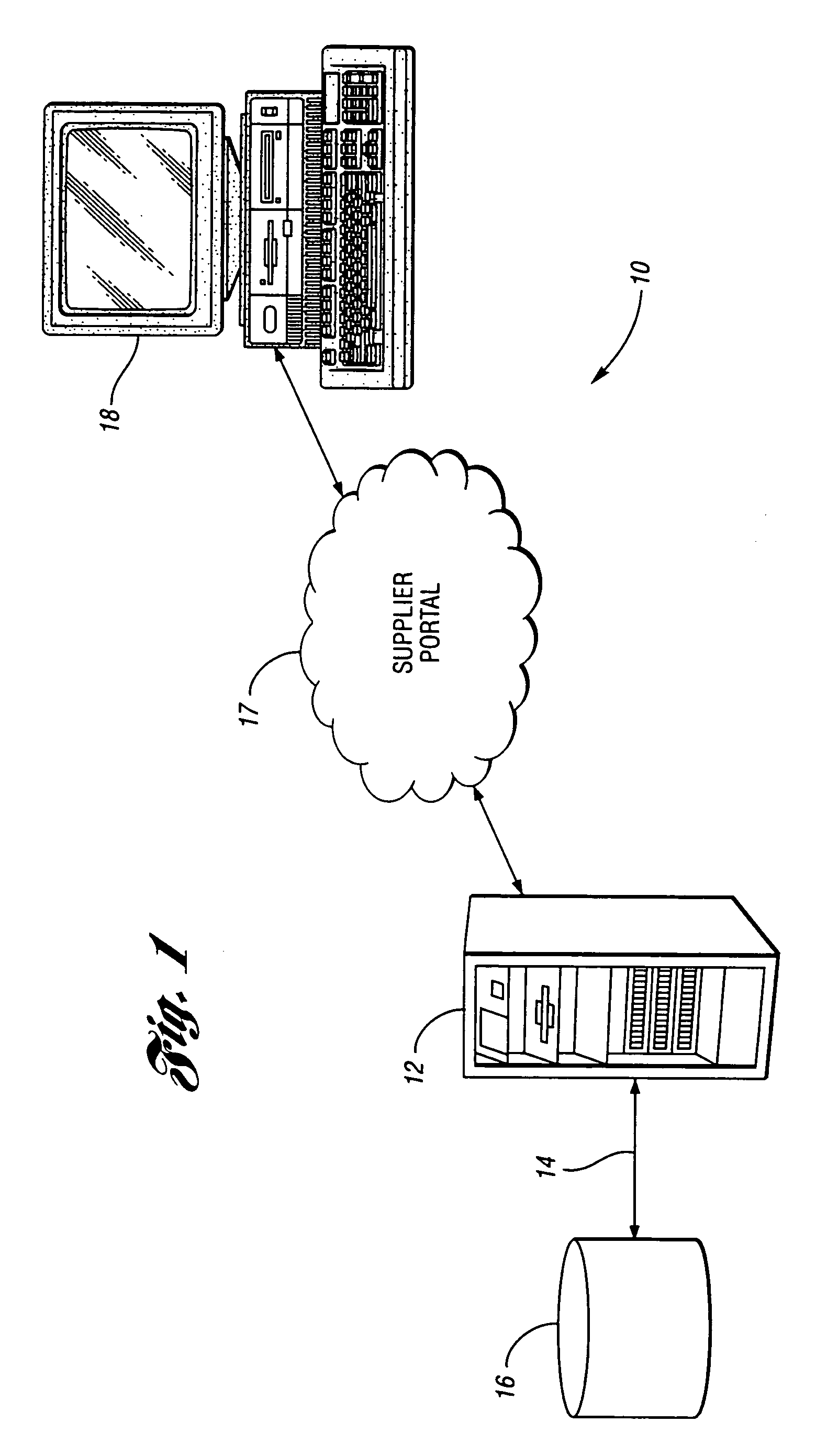

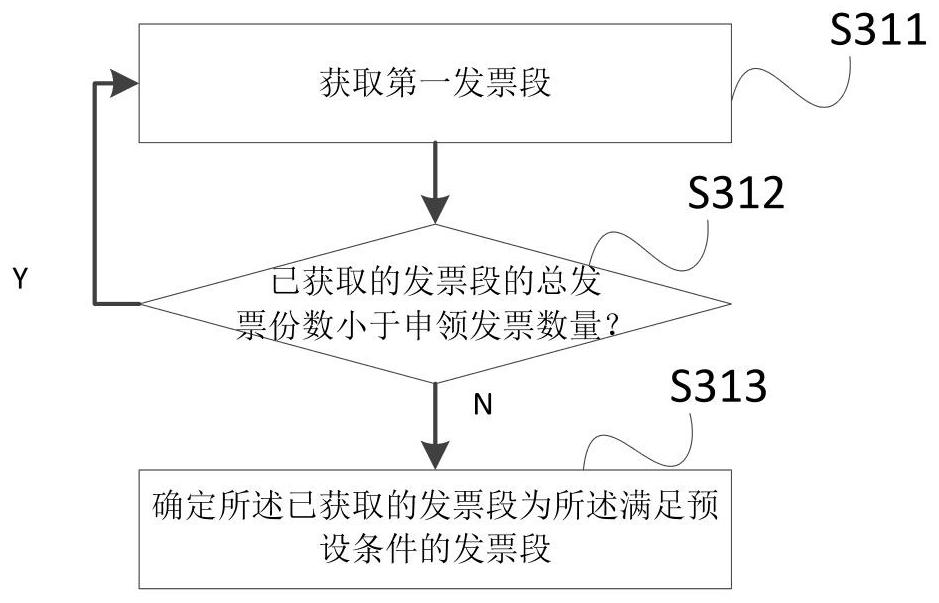

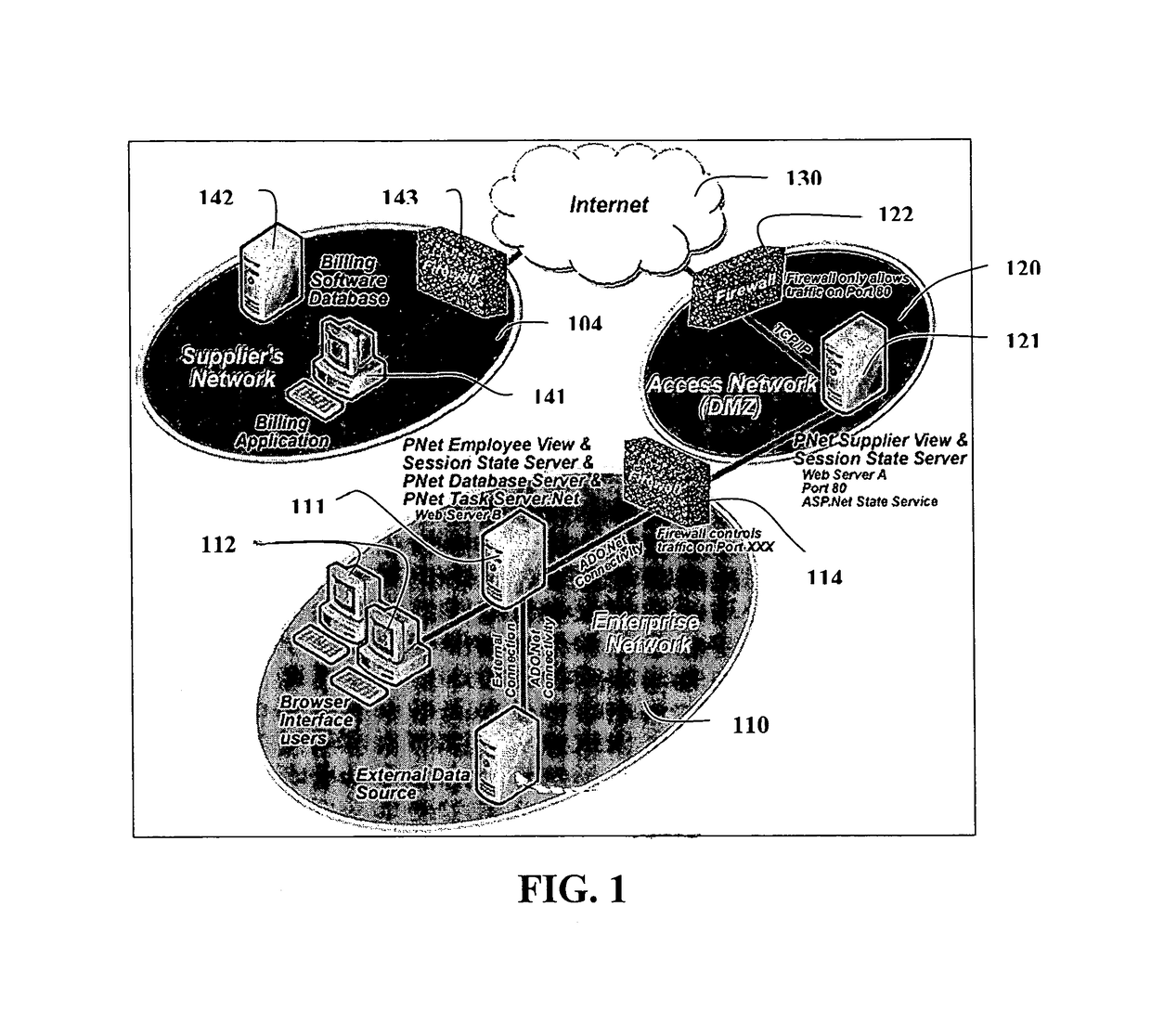

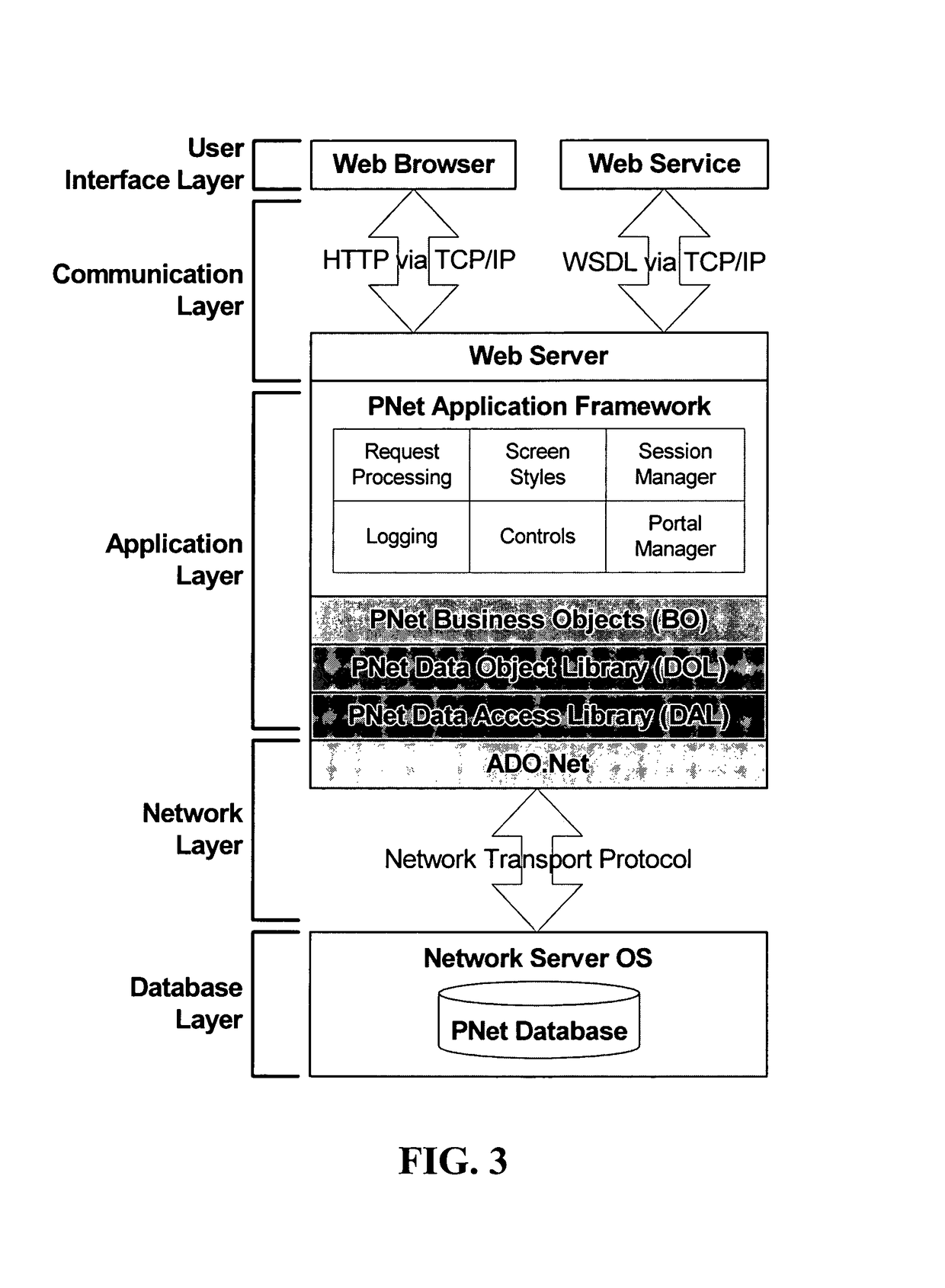

Electronic processing of invoices with no purchase orders

ActiveUS10181149B1Overcomes drawbackEasy accessBuying/selling/leasing transactionsInvoice typePurchase order

An electronic invoicing system performs an integrated method of processing both purchase order based electronic invoices and electronic invoices not associated with a purchase order or transaction receipt. A portal is provided by the system. The portal has respective views for a supplier submitting non-PO based type electronic invoices not associated with a purchase order or transaction receipt, and a user of an enterprise submitting and / or reviewing non-PO based type electronic invoices not associated with a purchase order or transaction receipt. An administrator of the enterprise configures electronic invoice types and processing parameters specific to said electronic invoice types not associated with a purchase order or transaction receipt. A submitted non-PO based type electronic invoice of a configured electronic invoice type is processed in accordance with the processing parameters configured by the administrator for that electronic invoice type.

Owner:VERSATA

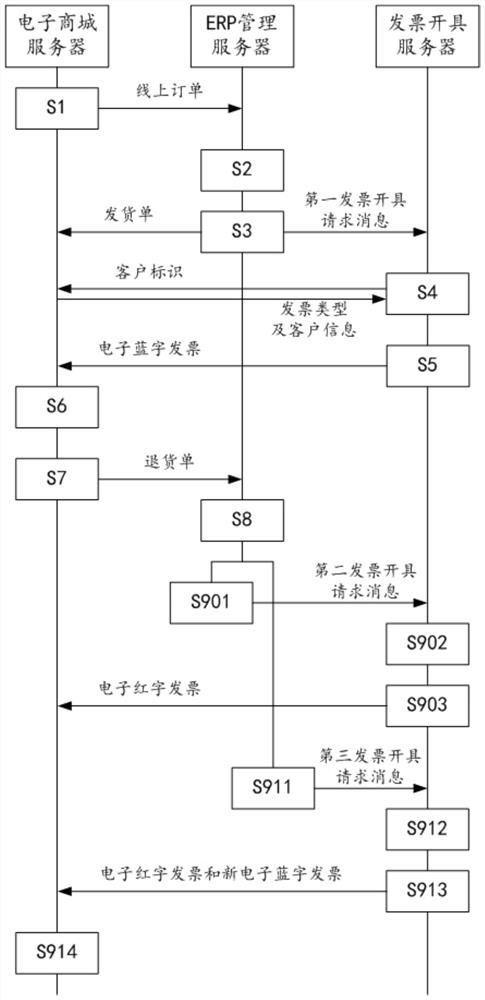

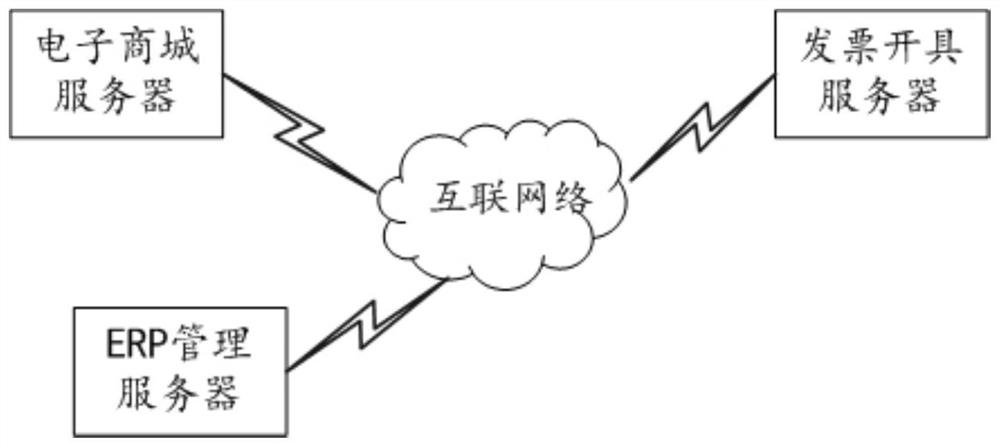

Automatic invoicing method and system

PendingCN114445165ABilling/invoicingBuying/selling/leasing transactionsInvoice typeMerchant services

The invention relates to the technical field of network services, and discloses an automatic invoicing method and system, and the method comprises the steps: transmitting an online order to an ERP management server after an electronic shopping mall server interacts with a client to achieve the online order, and then enabling the ERP management server to send an invoicing order to the client when the ERP management server obtains a delivery order corresponding to the online order. The method comprises the following steps of: feeding back a delivery order to an electronic mall server, initiating an invoice issuing request to an invoice issuing server, responding to the request by the invoice issuing server, automatically acquiring an invoice type and customer information which are recorded in the electronic mall server and are registered by a customer in advance, and issuing the invoice according to the invoice type, the customer information and the delivery order. According to the method, the electronic blue-character invoices corresponding to the delivery orders are generated, and finally the delivery orders and the electronic blue-character invoices are pushed to the client through the electronic mall server, so that invoices are automatically issued along with the delivery progress in the whole ordering and delivery process, manual operation of merchant service personnel is not needed, and the purposes of work simplification and efficiency improvement are achieved.

Owner:荃豆数字科技有限公司

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com