Patents

Literature

172 results about "Computer telephony integration" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Computer telephony integration, also called computer–telephone integration or CTI, is a common name for any technology that allows interactions on a telephone and a computer to be integrated or coordinated. The term is predominantly used to describe desktop-based interaction for helping users be more efficient, though it can also refer to server-based functionality such as automatic call routing.

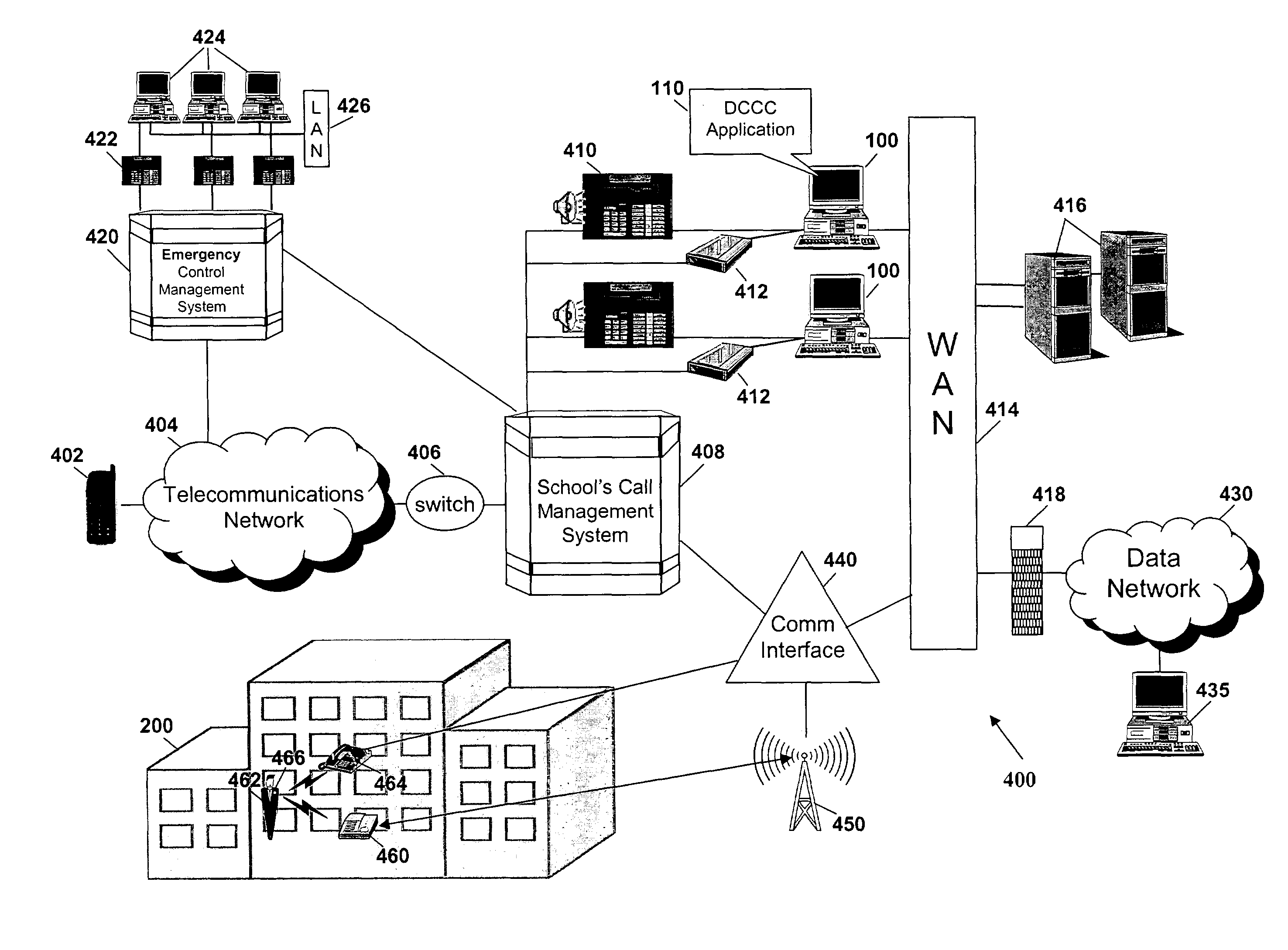

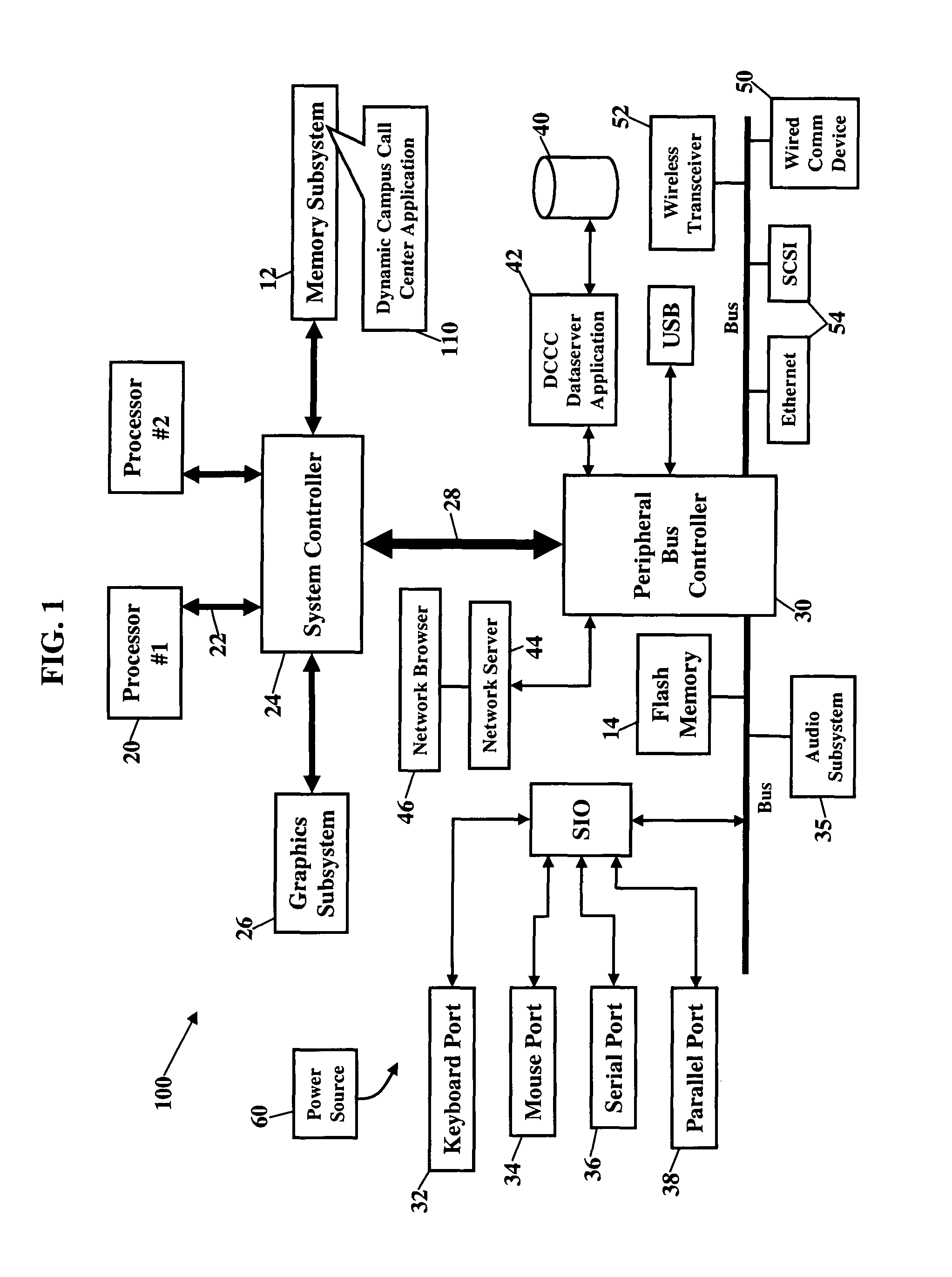

Computer telephony integration (CTI) systems and methods for enhancing school safety

ActiveUS8149823B2Enhancing school safetyFast notification of emergencySpecial service provision for substationMultiplex system selection arrangementsCommunications systemTelecommunications network

Methods and systems are disclosed for enabling a dynamic computer telephony integration campus call center that leverages the assets of a school communications system including internal telecommunications networks, information systems, data networks, and applications, of public telecommunications networks, of public data networks, and / or of various communications devices to facilitate improved access, sharing, notification, and / or management of communications (e.g., external and internal communications) and associated data to enhance school safety services.

Owner:BELLSOUTH INTPROP COR

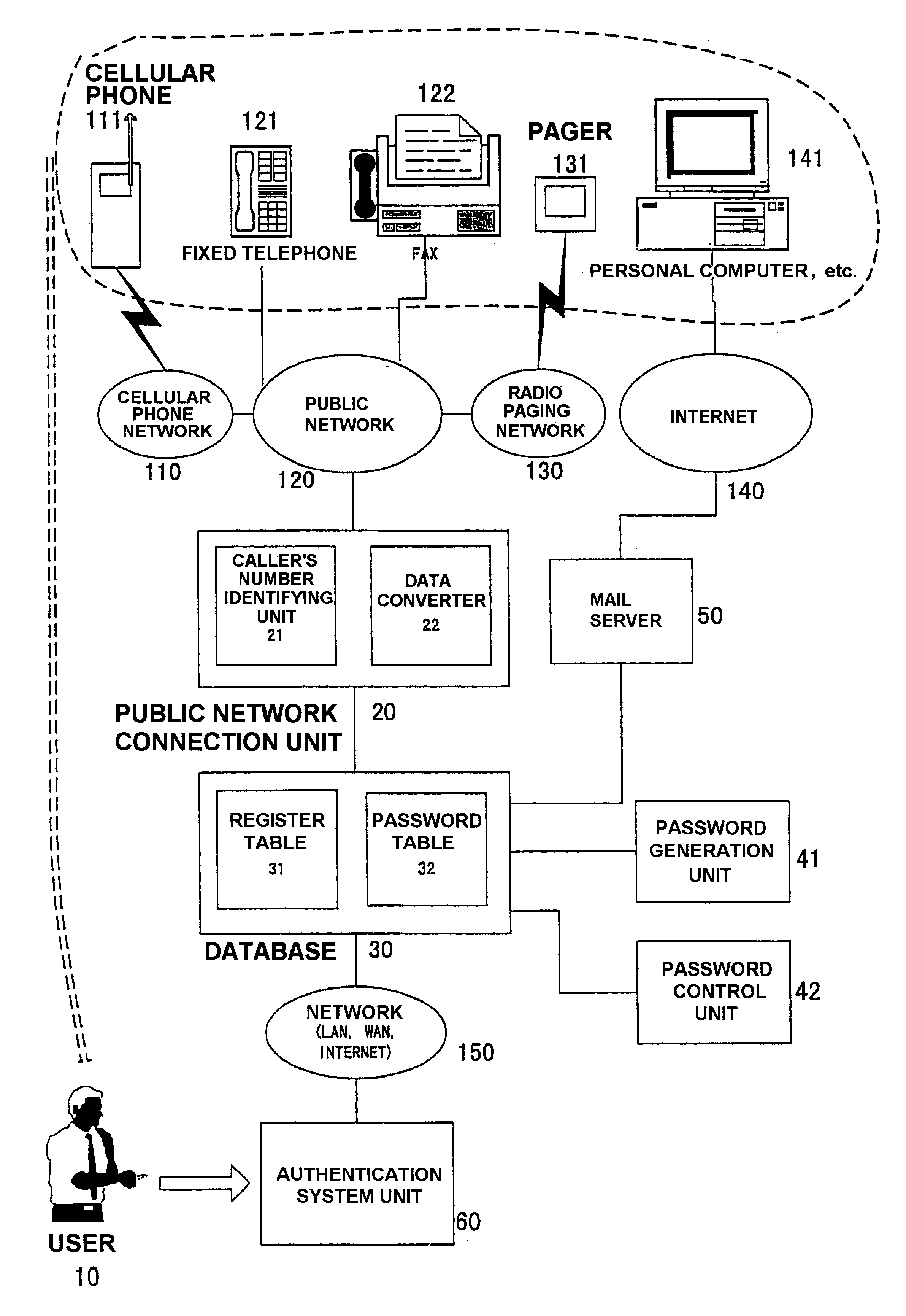

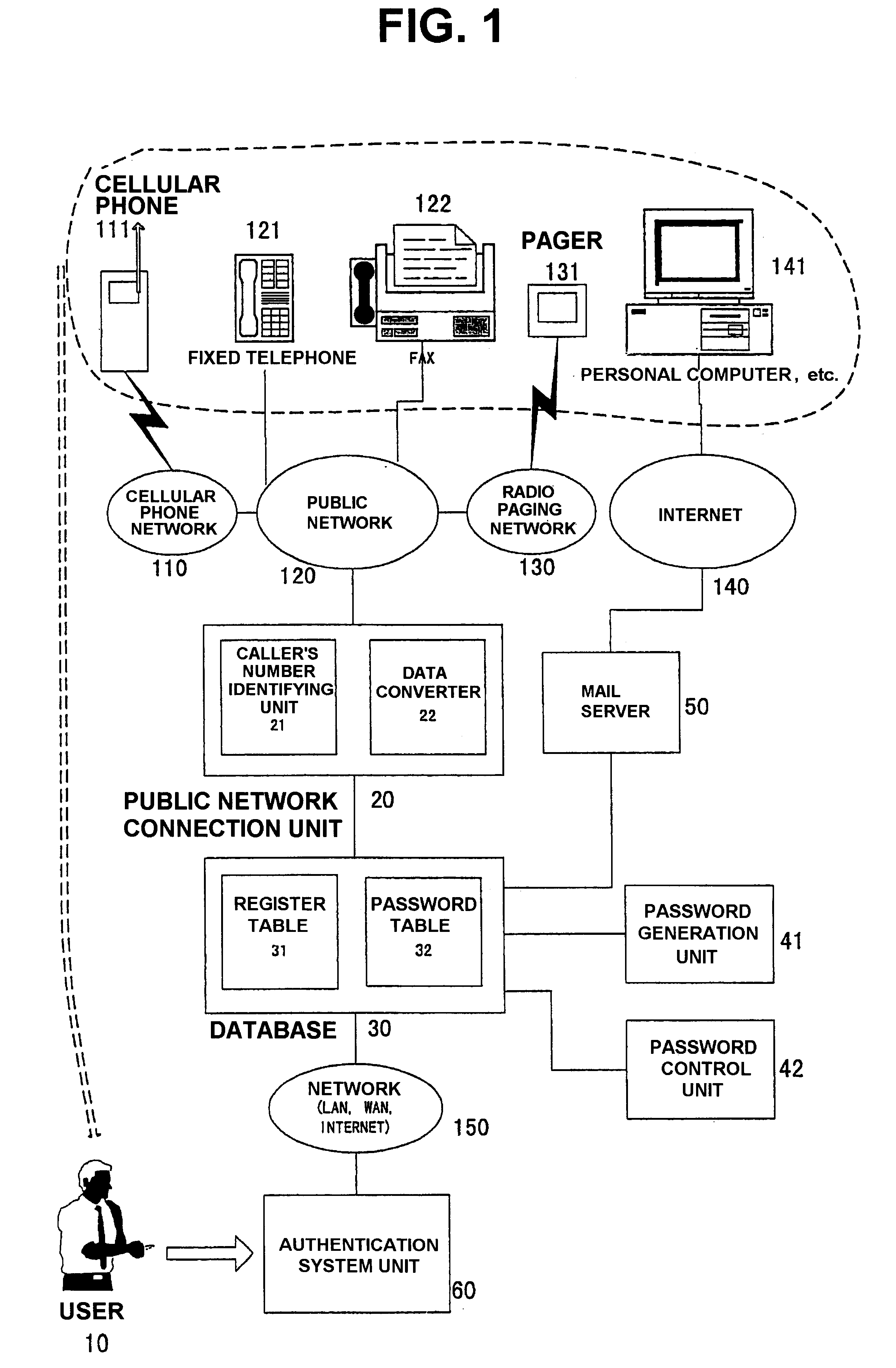

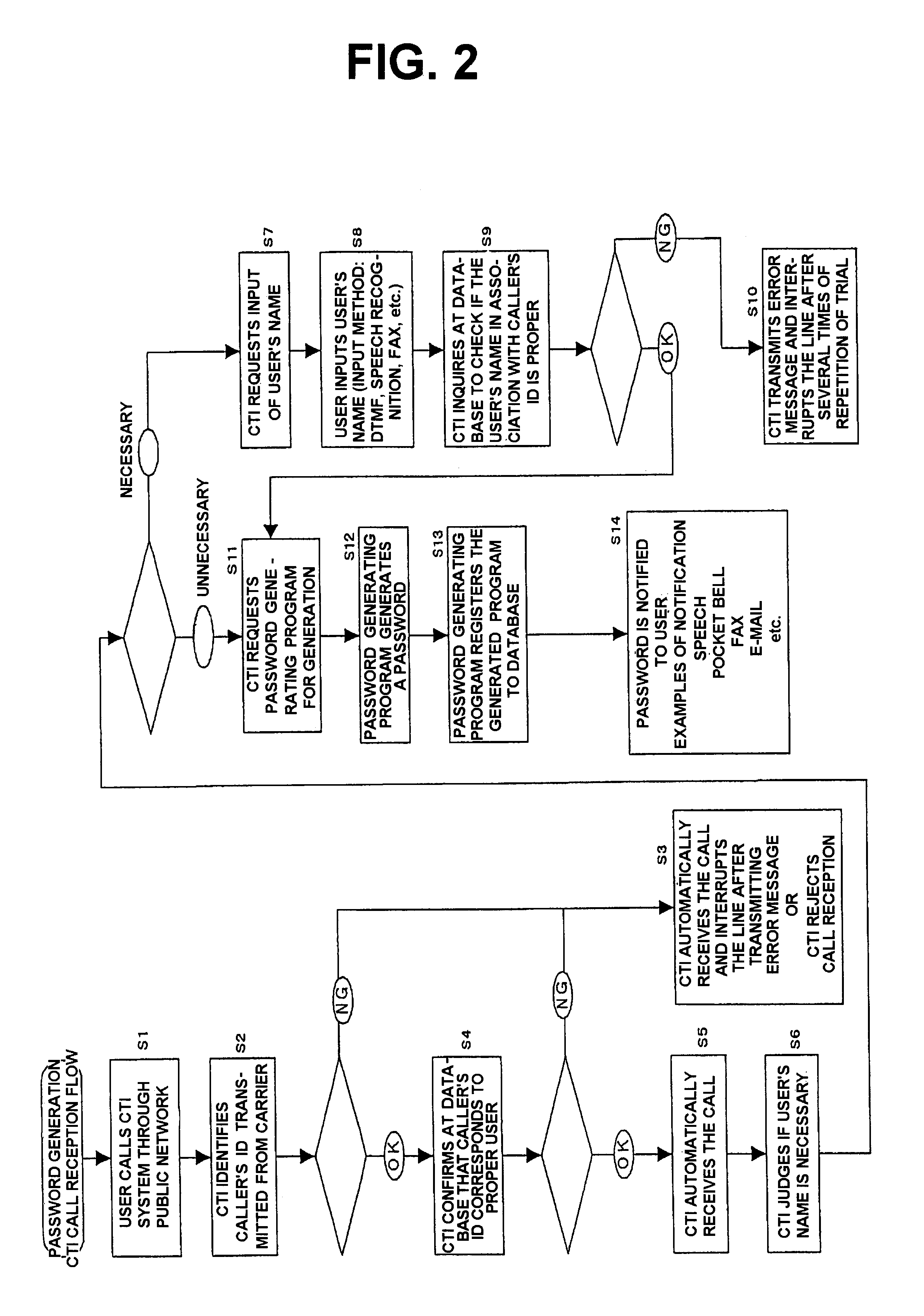

Authentication method, authentication system and recording medium

InactiveUS6731731B1Improve securityEasy to operateDigital data processing detailsUser identity/authority verificationInformation processingPassword

When a service provider authenticates a preliminarily registered user, a telephone number of a telephone of the user is registered prior to the authentication and the user calls a CTI (computer telephony integration) server by the use of the telephone. The CTI server authenticates the user with reference to the telephone number of the call received. A password is generated by an information processing device such as the CTI server and is transmitted to both the user and the service provider. The service provider compares the received password and a password inputted by the user and provides the user with service upon coincidence between both passwords.

Owner:COMSQUARE

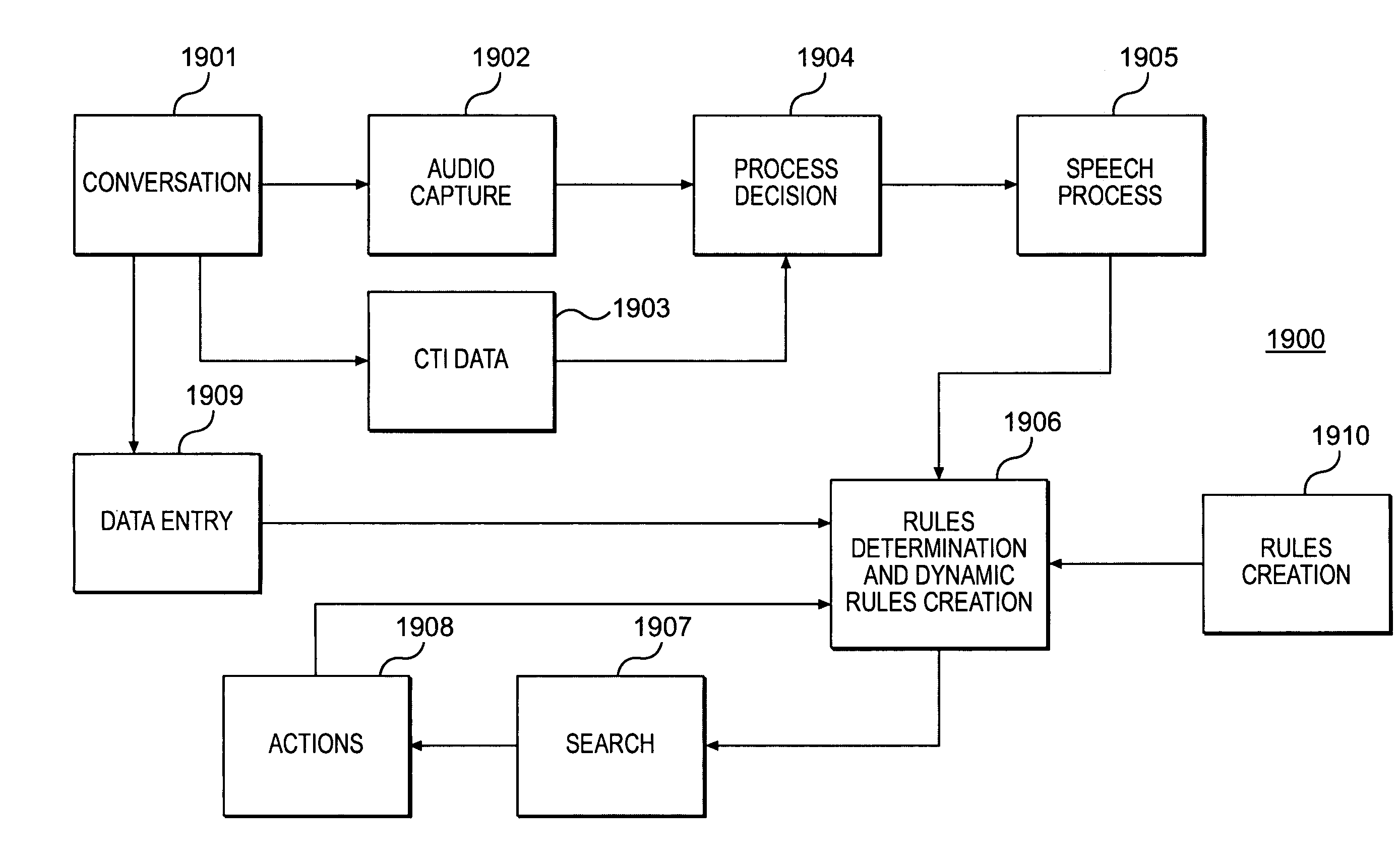

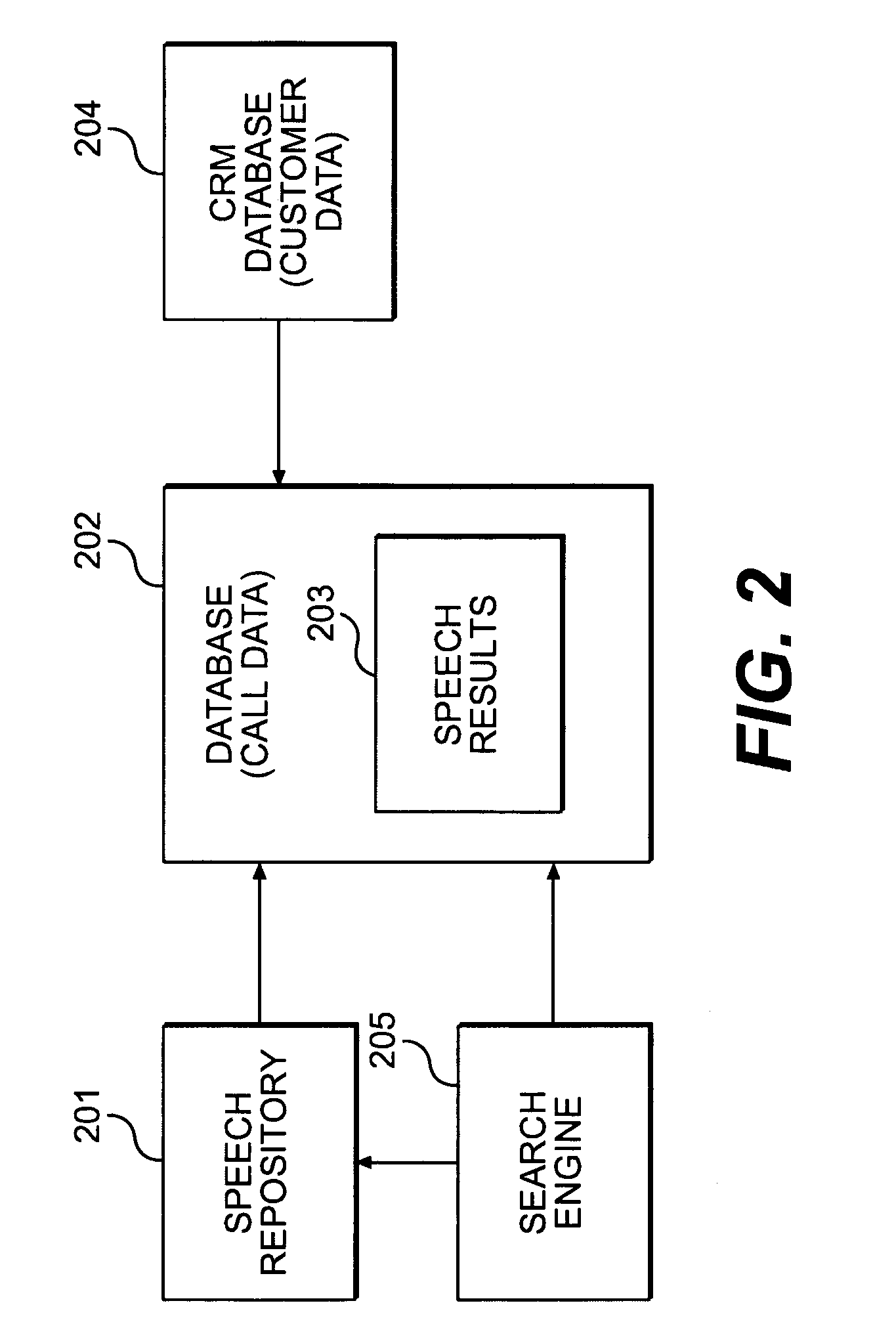

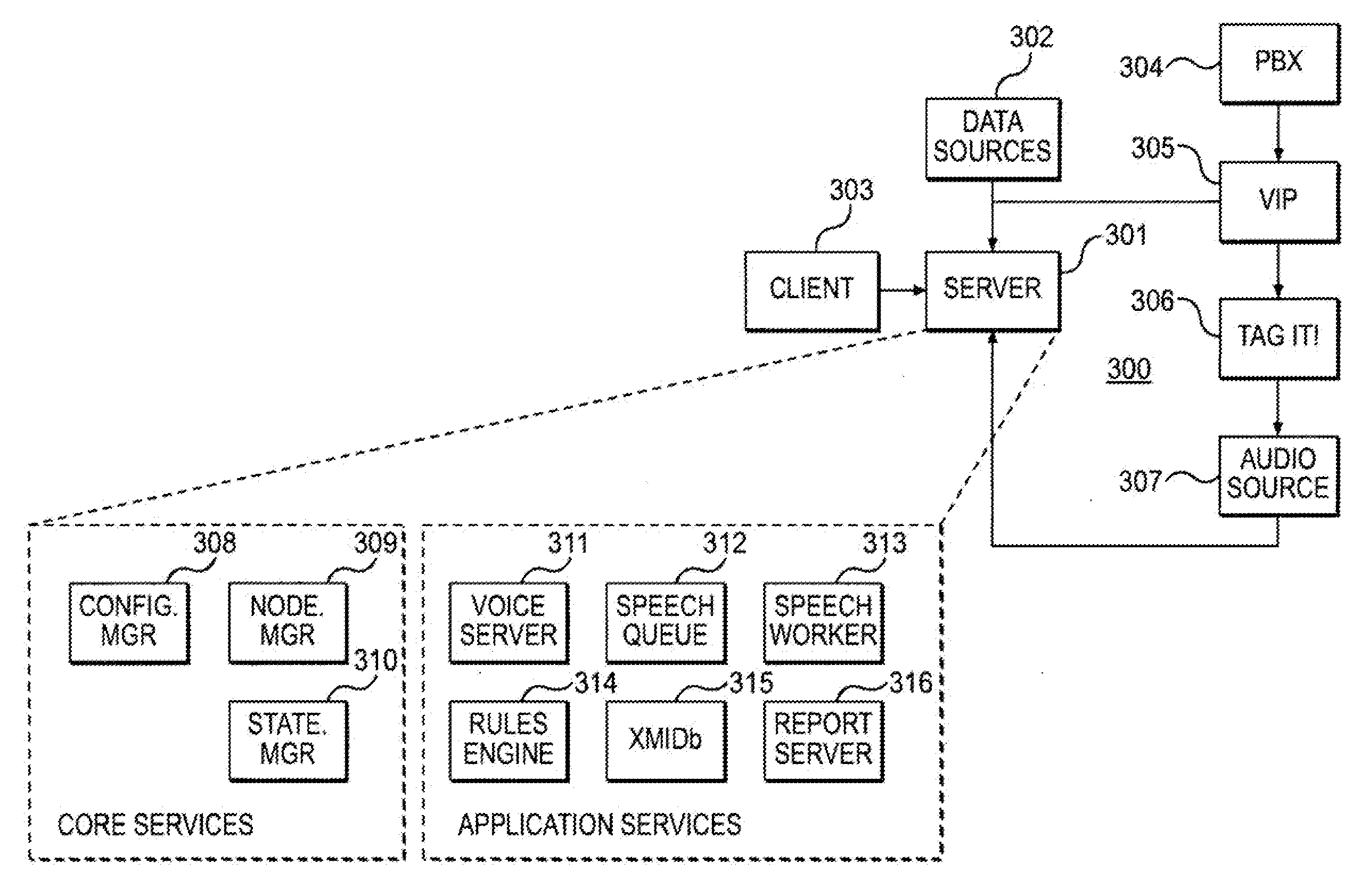

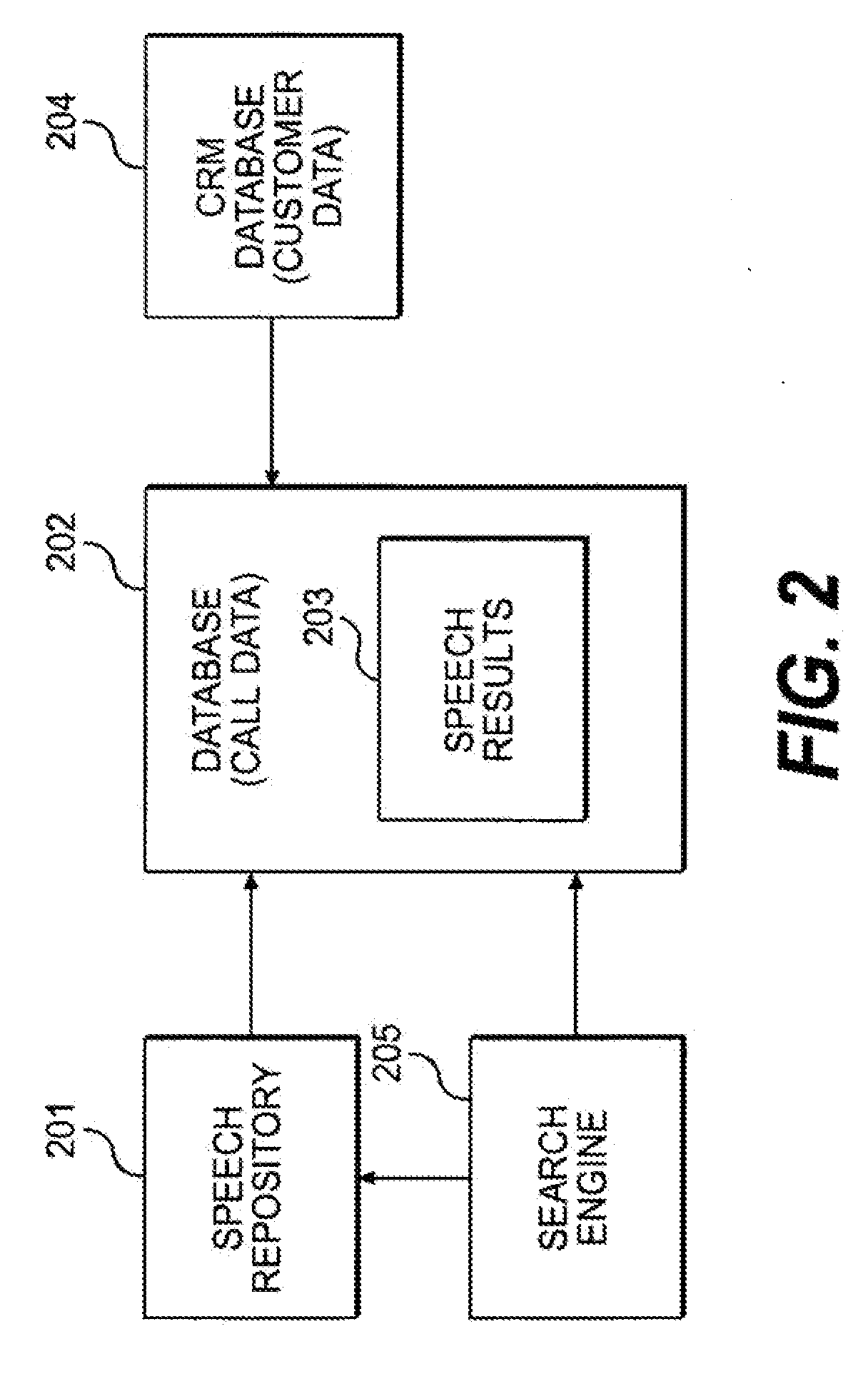

Methods and apparatus for audio data monitoring and evaluation using speech recognition

ActiveUS7076427B2Simplify the search processSupervisory/monitoring/testing arrangementsManual exchangesEngineeringIntegration platform

The present invention relates to audio data monitoring using speech recognition technology. In particular, the present invention uses business rules combined with unrestricted, natural speech recognition to monitor conversations in a customer interaction environment, literally transforming the spoken word to a retrievable data form. Implemented using the VorTecs Integration Platform (VIP), a flexible Computer Telephony Integration base, the present invention enhances quality monitoring by effectively evaluating conversations and initiating actionable events while observing for script adherence, compliance and / or order validation.

Owner:RINGCENTRAL INC

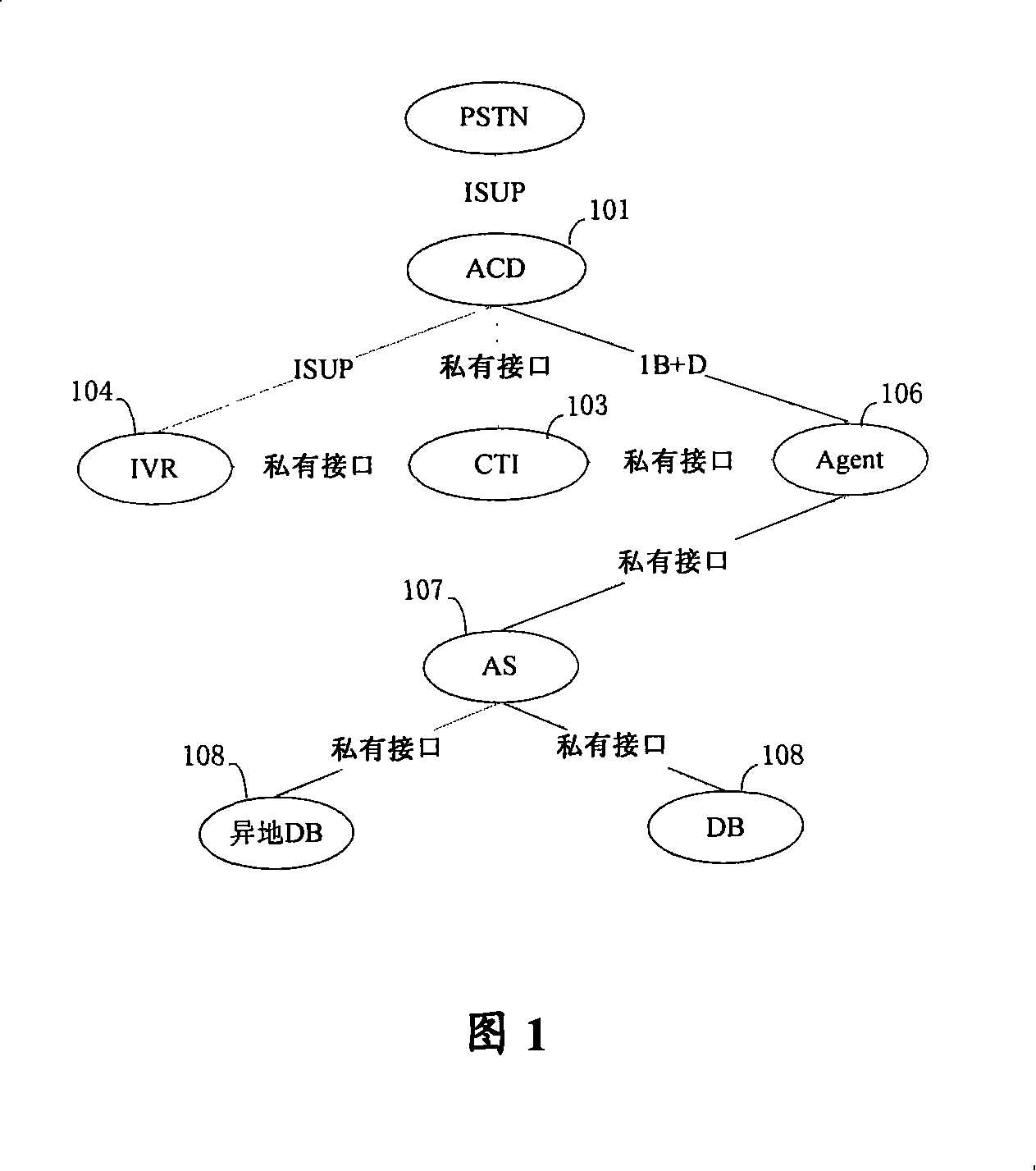

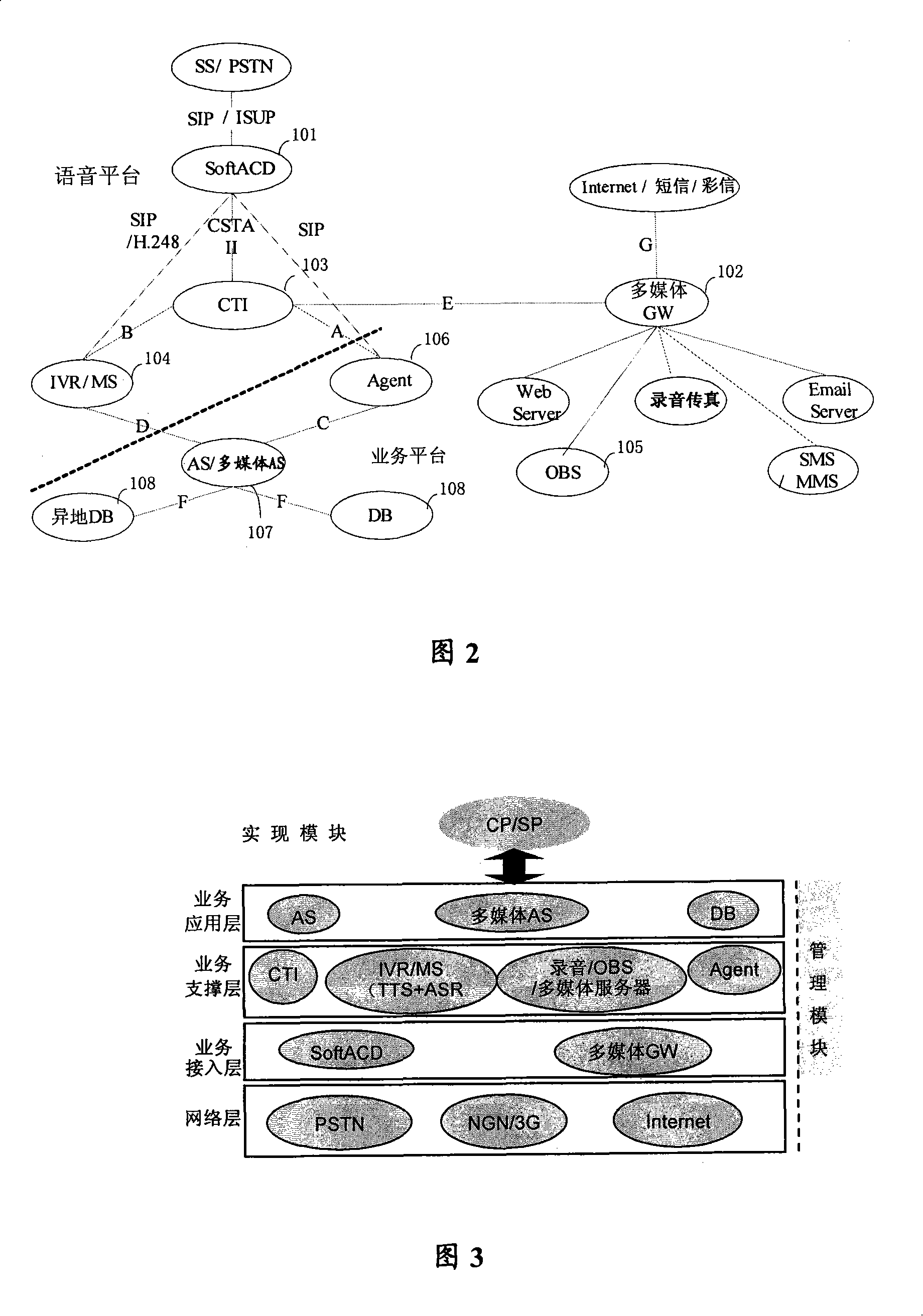

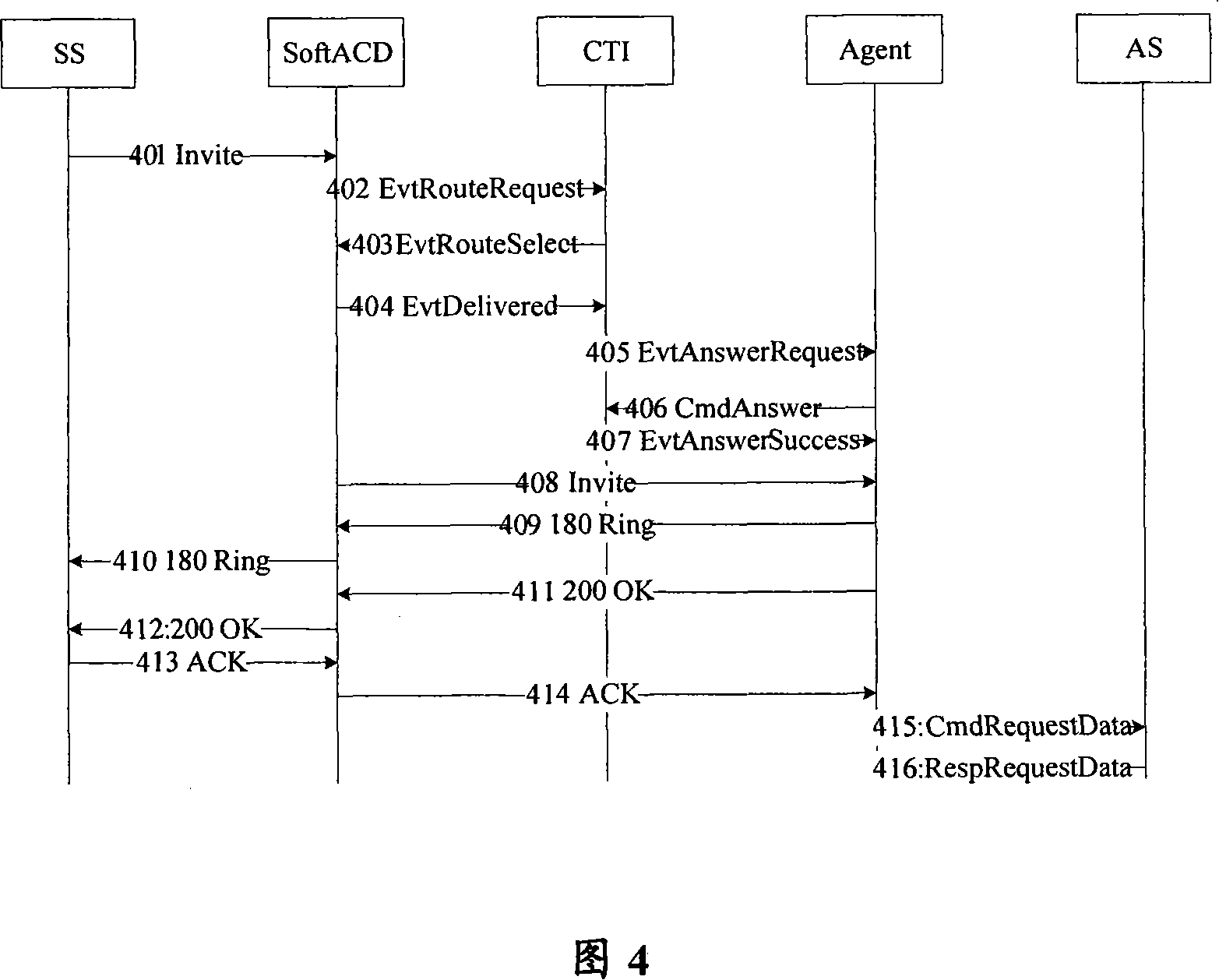

A new generation call center system and automatic service realization method

ActiveCN101150419ARealize automatic voice serviceImplement multimedia servicesSpecial service provision for substationSpecial service for subscribersInterface protocolInteractive voice response system

This invnetion discloses a new generation call center (NGCC) system including an automatic call device ADC, a computer telephone integrated device CTI, an interactive voice response system IVR, a seat agent, an applied server AS and a database DB, in which, said ACD is used in mapping call requests of different signaling protocols from wide and narrow band network to a unified call matter and reports it to CTI device by a standard and open interface protocol and finishes the control process of call voice or video multimedia channel, said CTI device is used in boosting up queue to the reported call access request and route control to dispatch and manage the seats and IVR unifiedly, said IVR is used in analyzing and executing the automatic service logic and providing media resource ability.

Owner:CHINA TELECOM CORP LTD

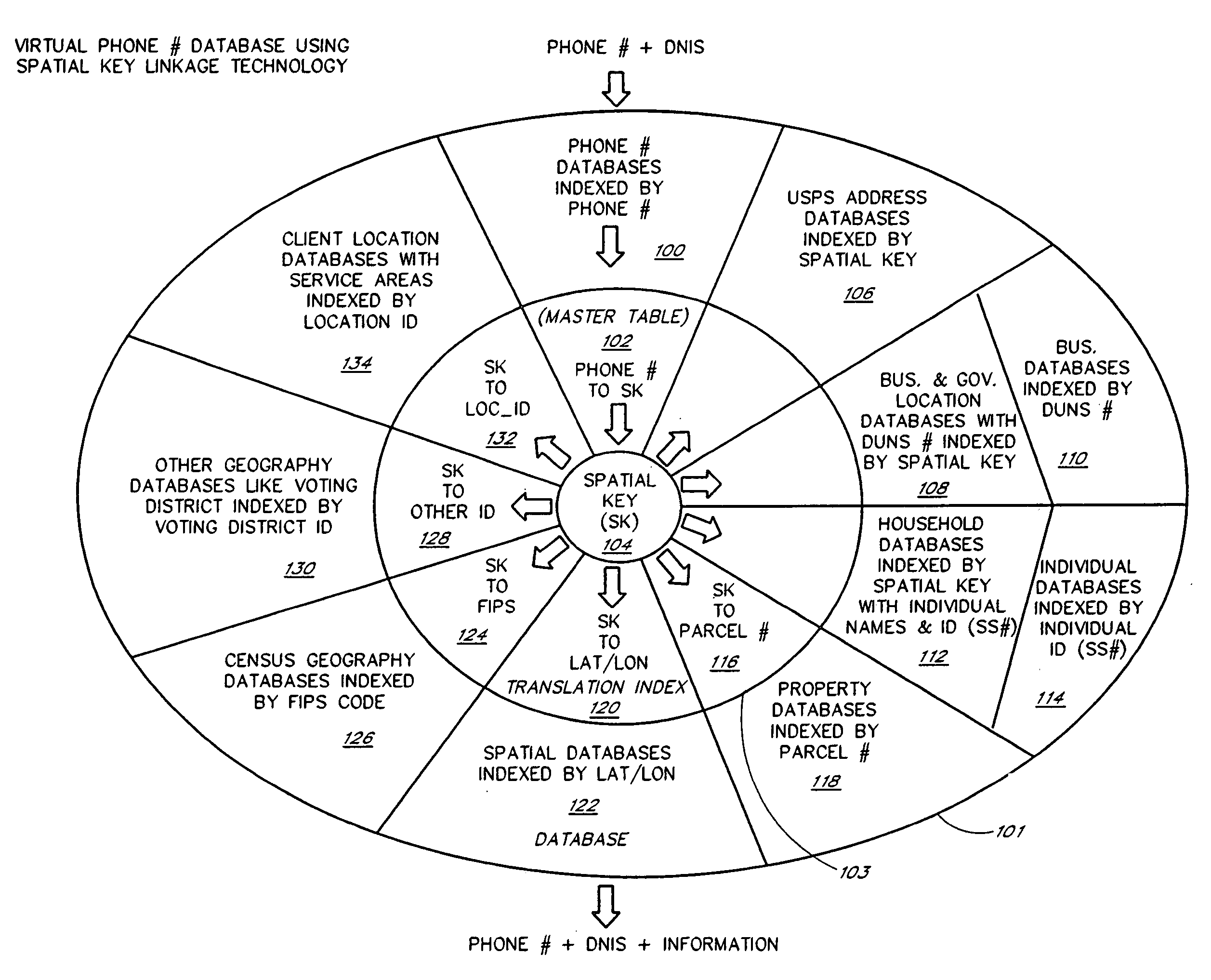

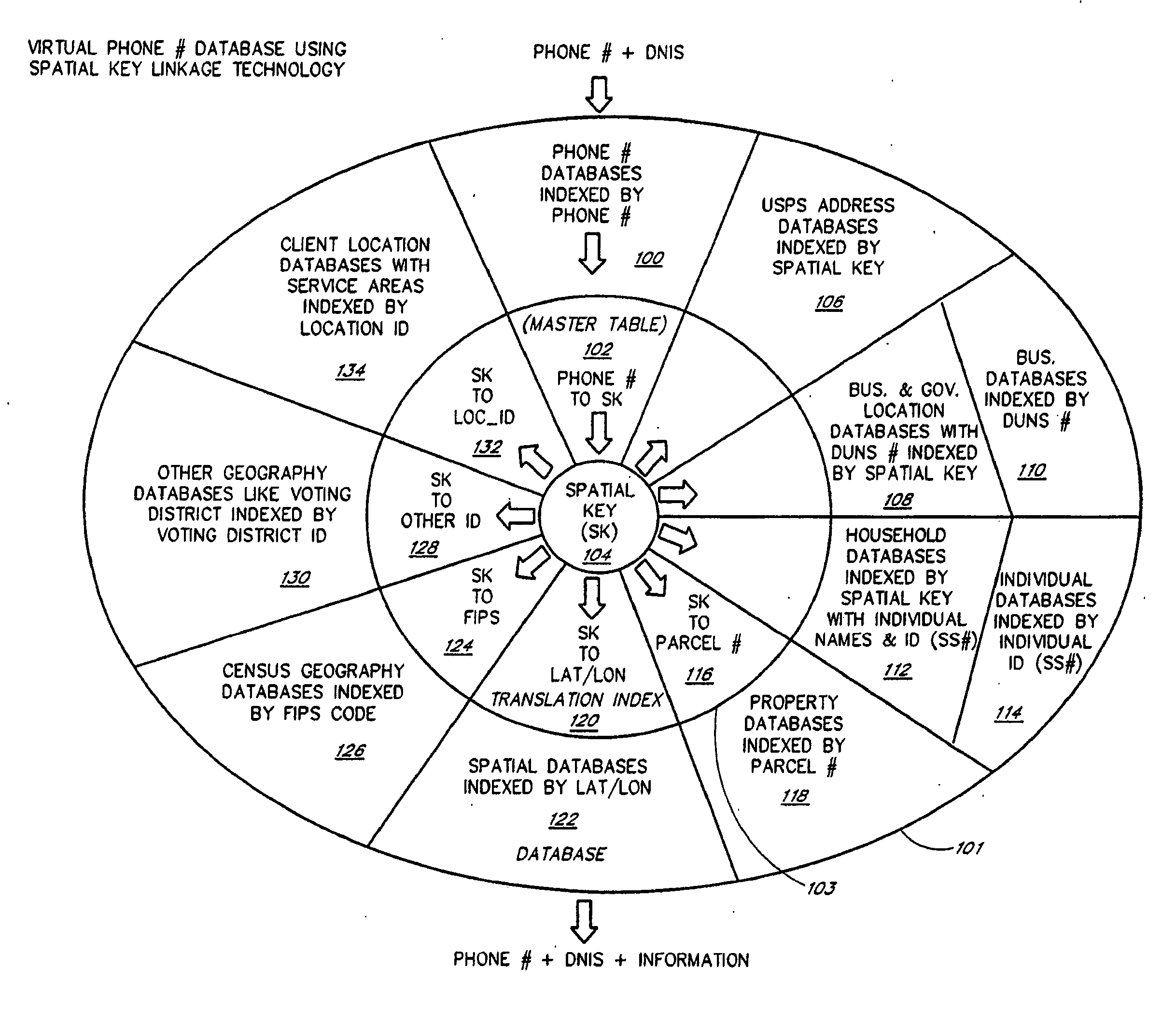

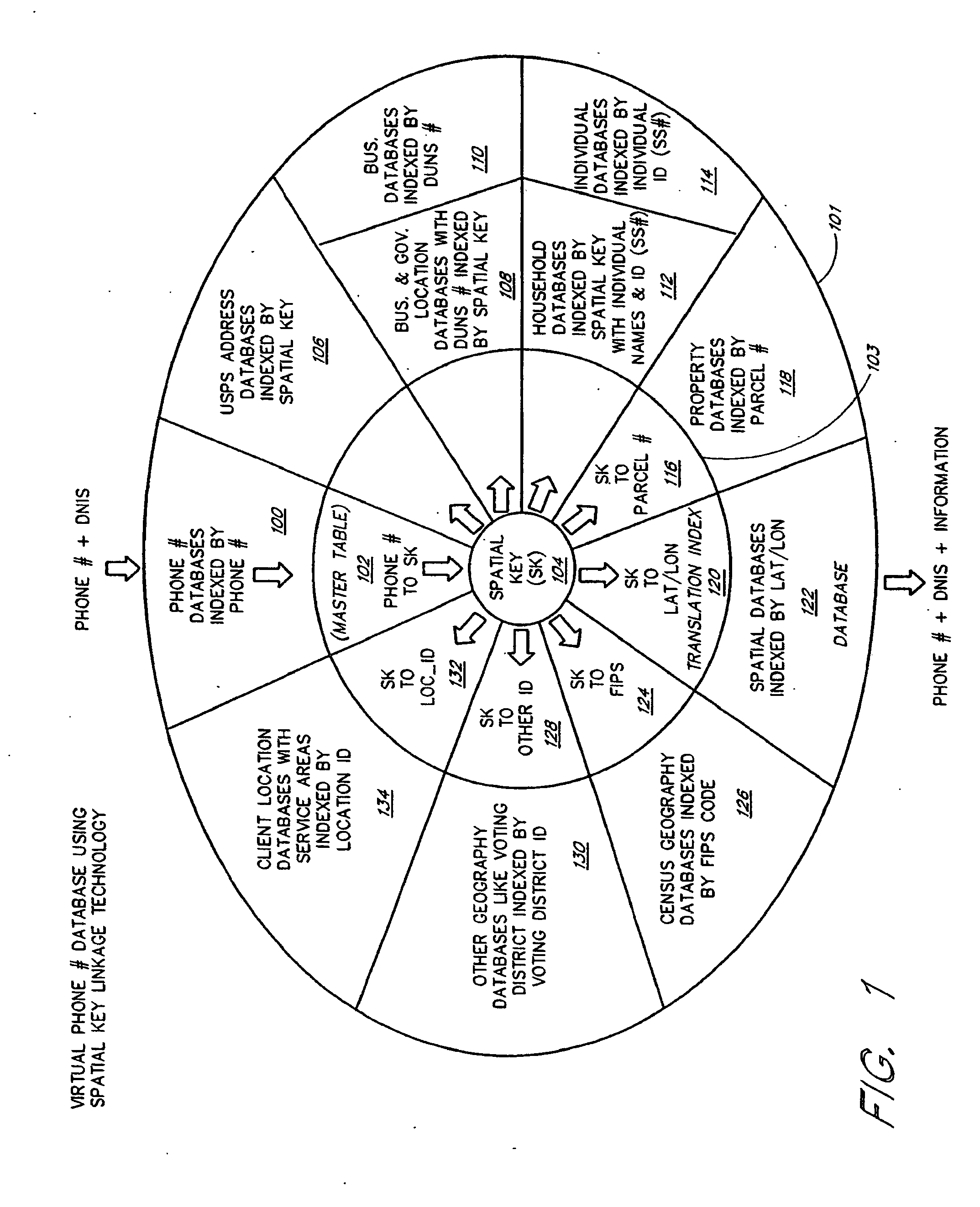

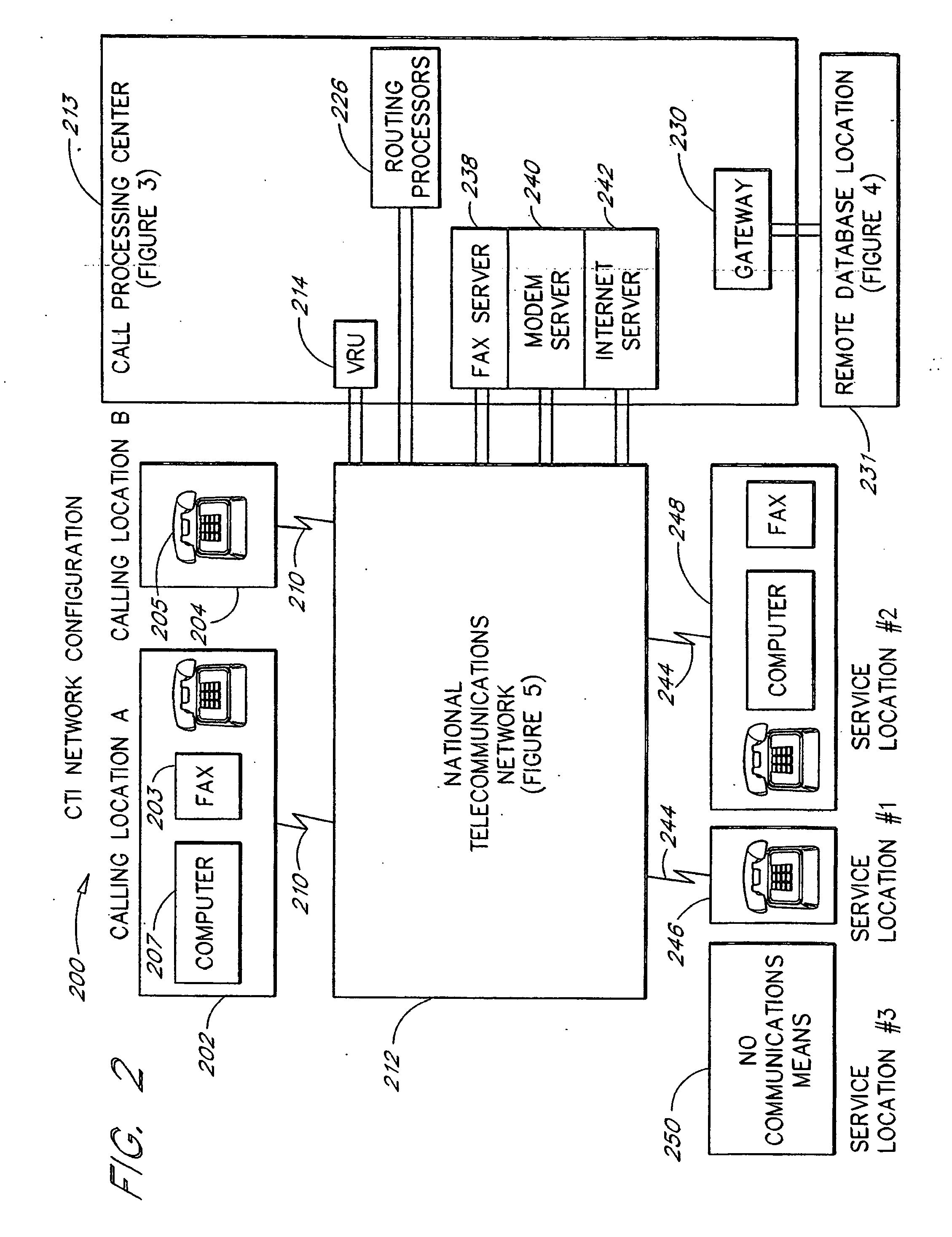

One number, intelligent call processing system

InactiveUS7167553B2Expand coverageAutomatic call-answering/message-recording/conversation-recordingSpecial service for subscribersTelecommunications networkEngineering

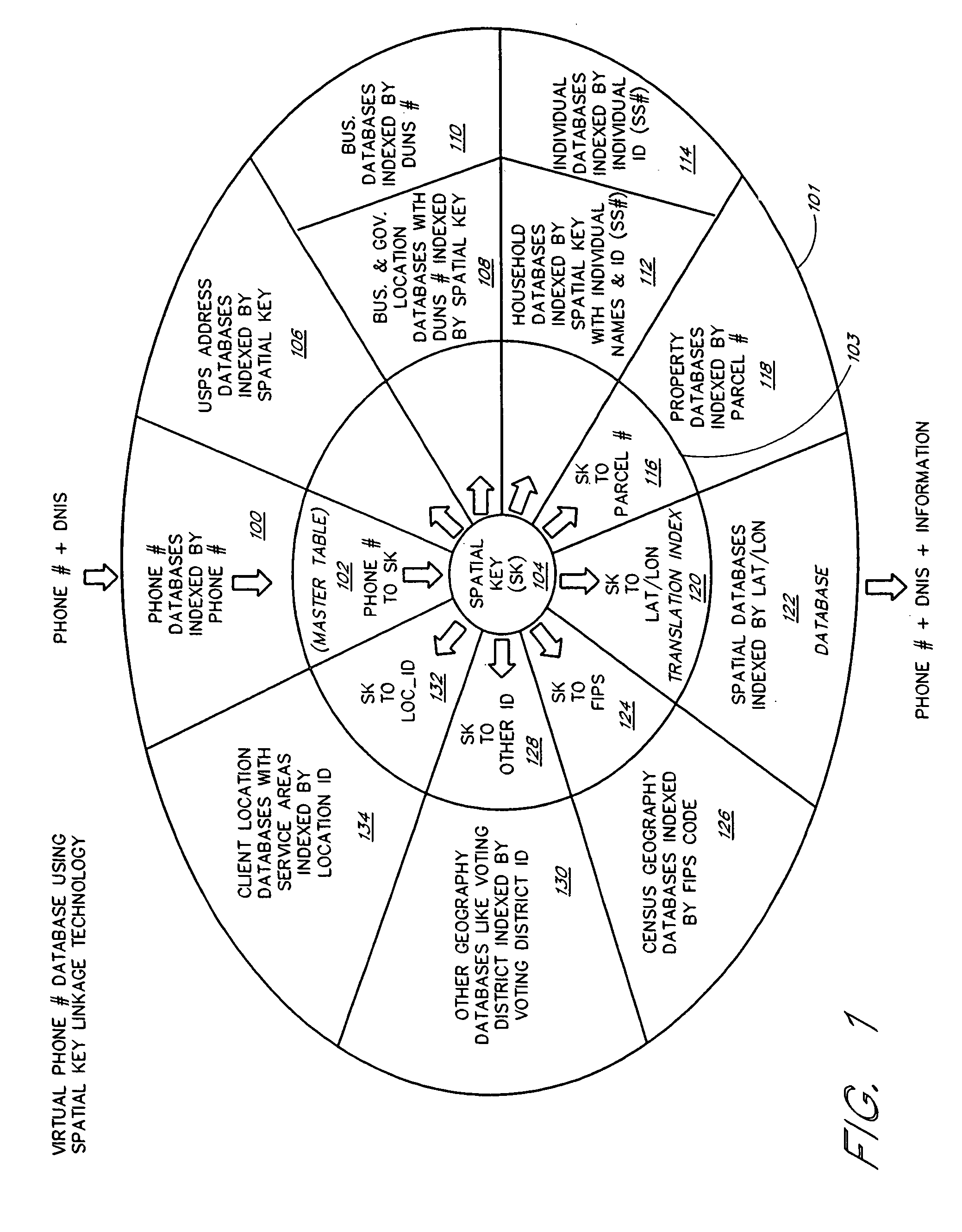

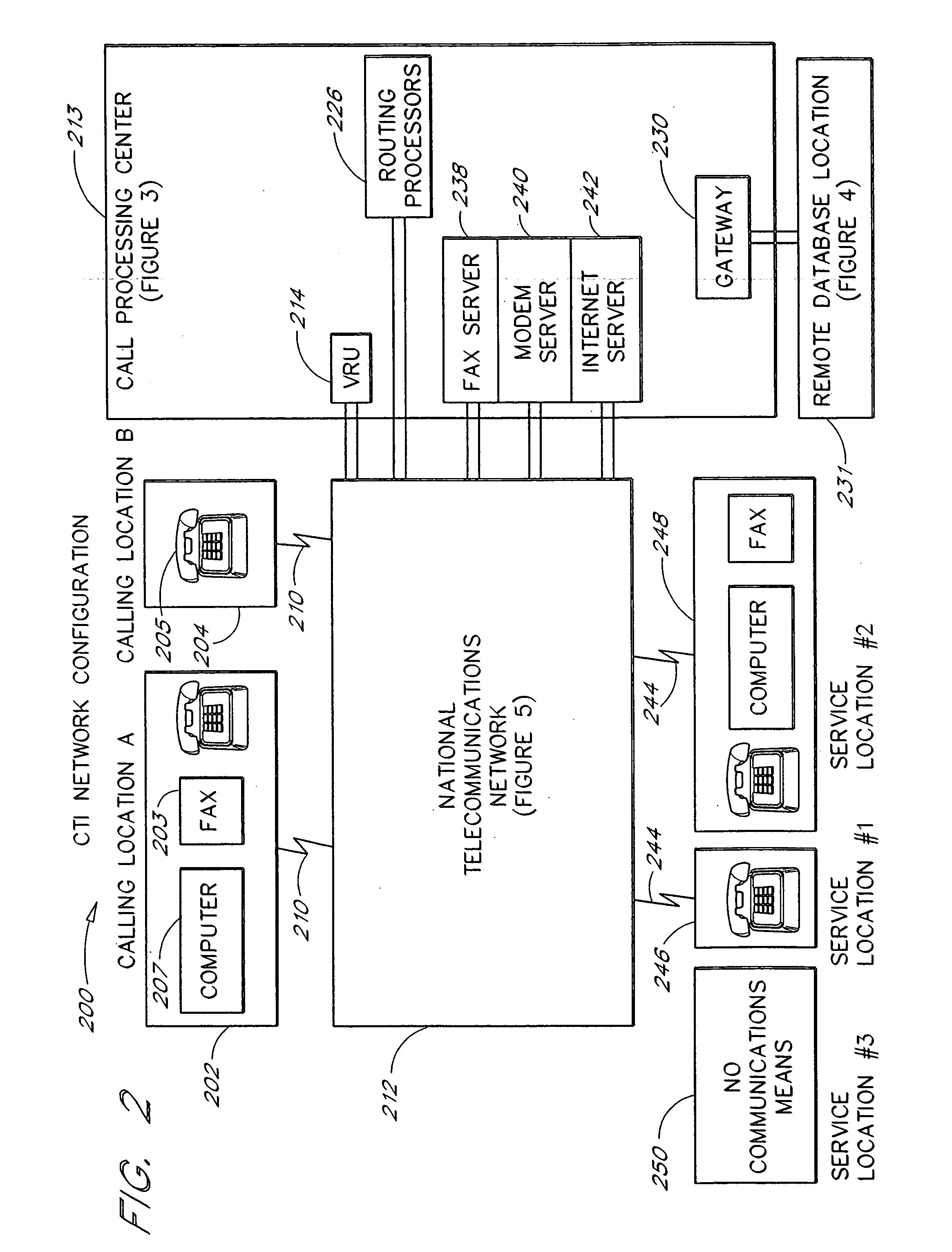

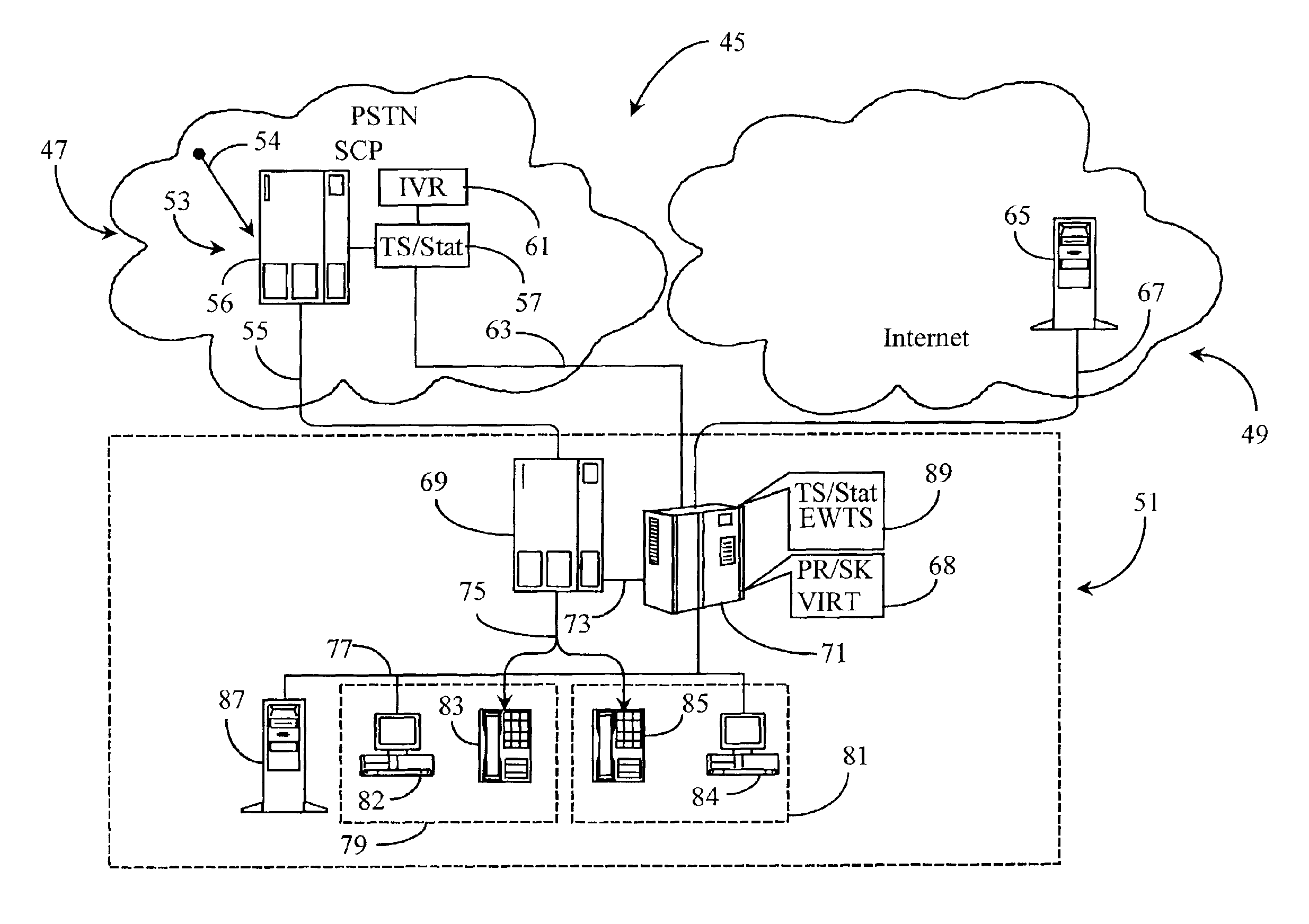

A one number, multi-application, intelligent call processing system provides service benefits to a caller, a servicing location and / or a vanity number advertiser during a call, parallel to the call and / or post call in an integrated common architecture. The system utilizes VRU technology in conjunction with the national telecommunications network connected via Computer Telephone Integration (CTI) to a virtual telephone number database containing a nationwide master list of telephone numbers with attribute data items associated by Spatial Key linkage to each telephone number. The process of the invention is initiated by a caller dialing a selected telephone number to request information and / or services. Based on the number dialed, a caller or network provided ten-digit telephone number and VRU prompted for and received caller input, the system retrieves the application requested data from the virtual telephone number database and provides it to the network.

Owner:MUREX SECURITIES

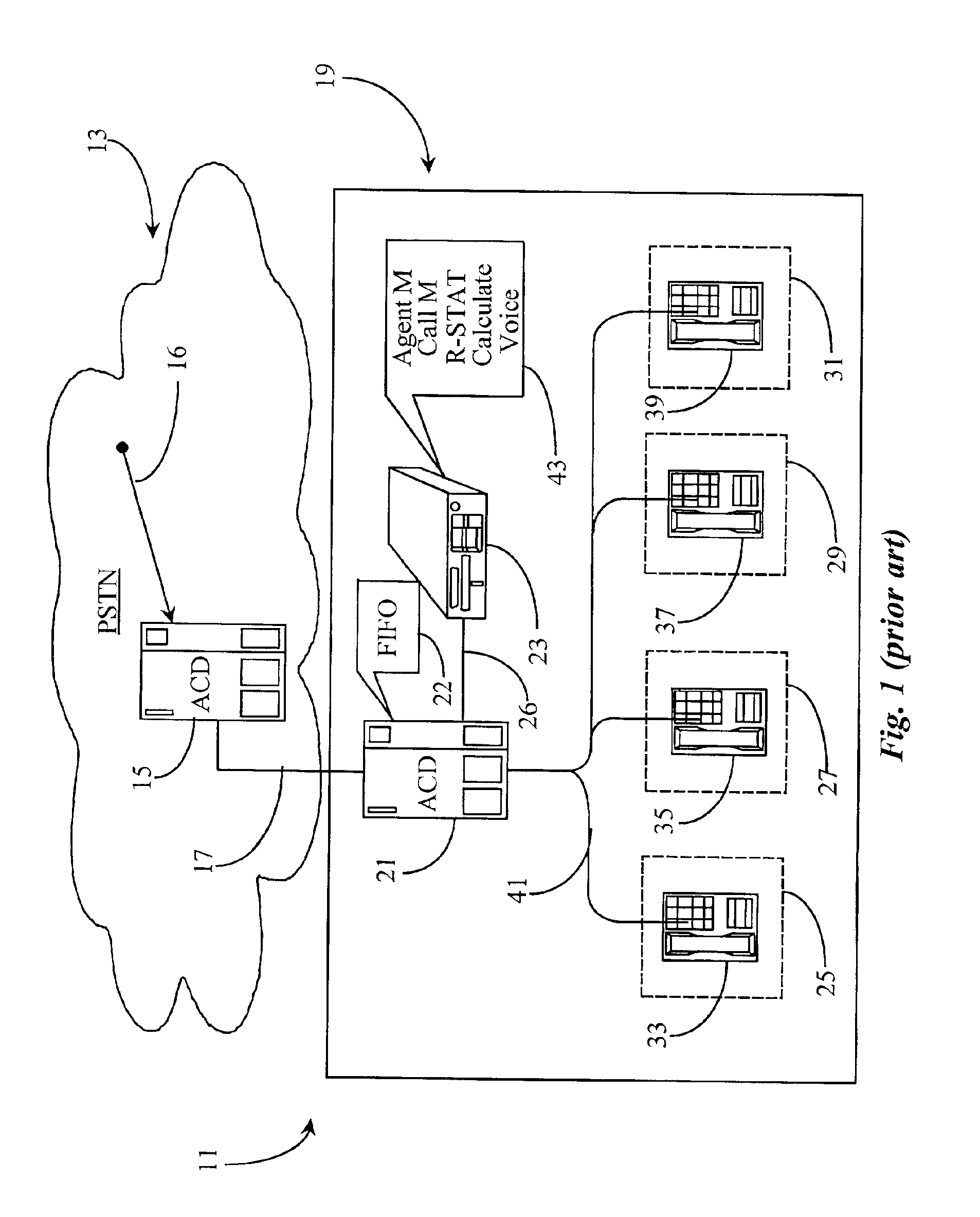

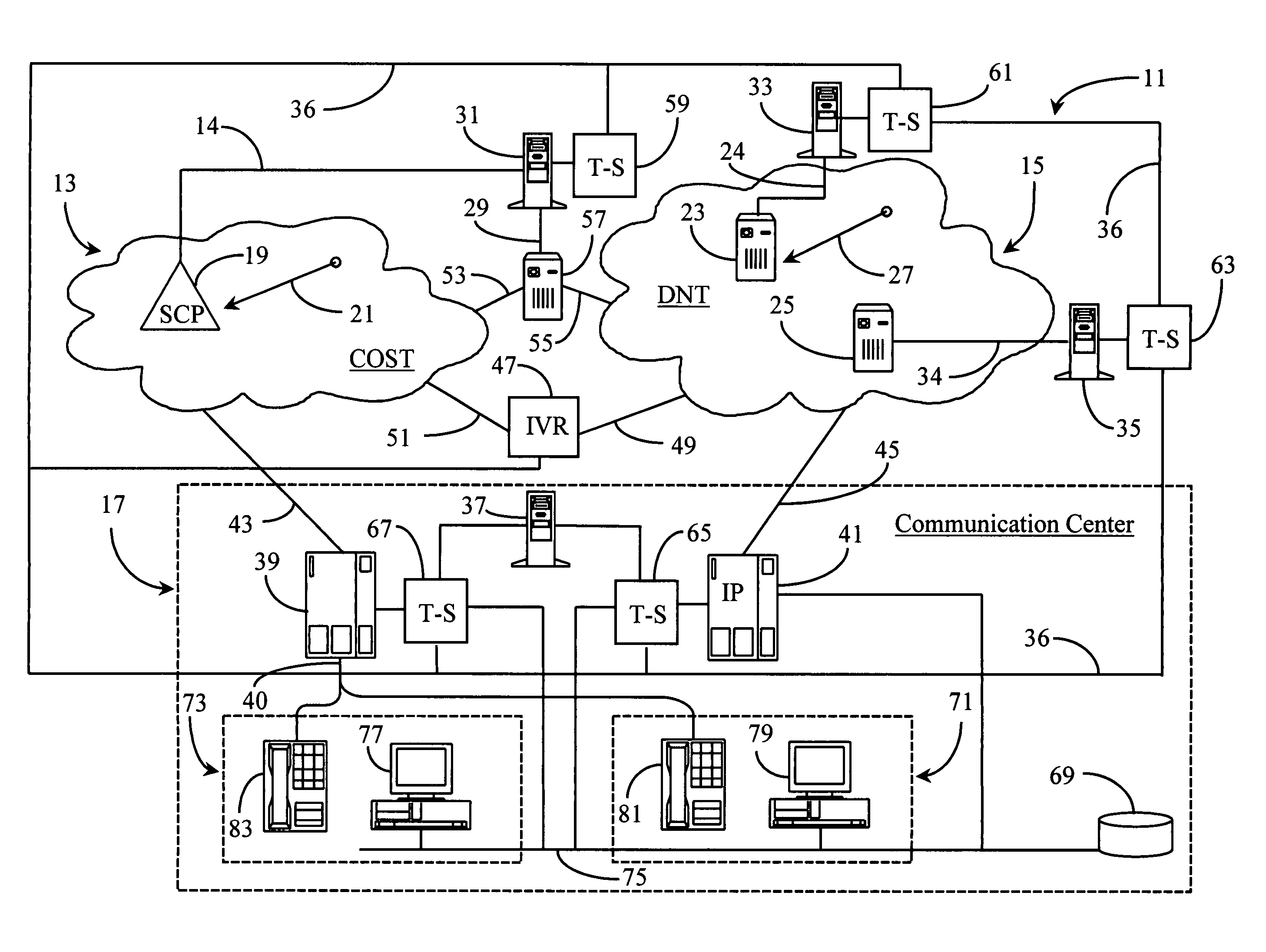

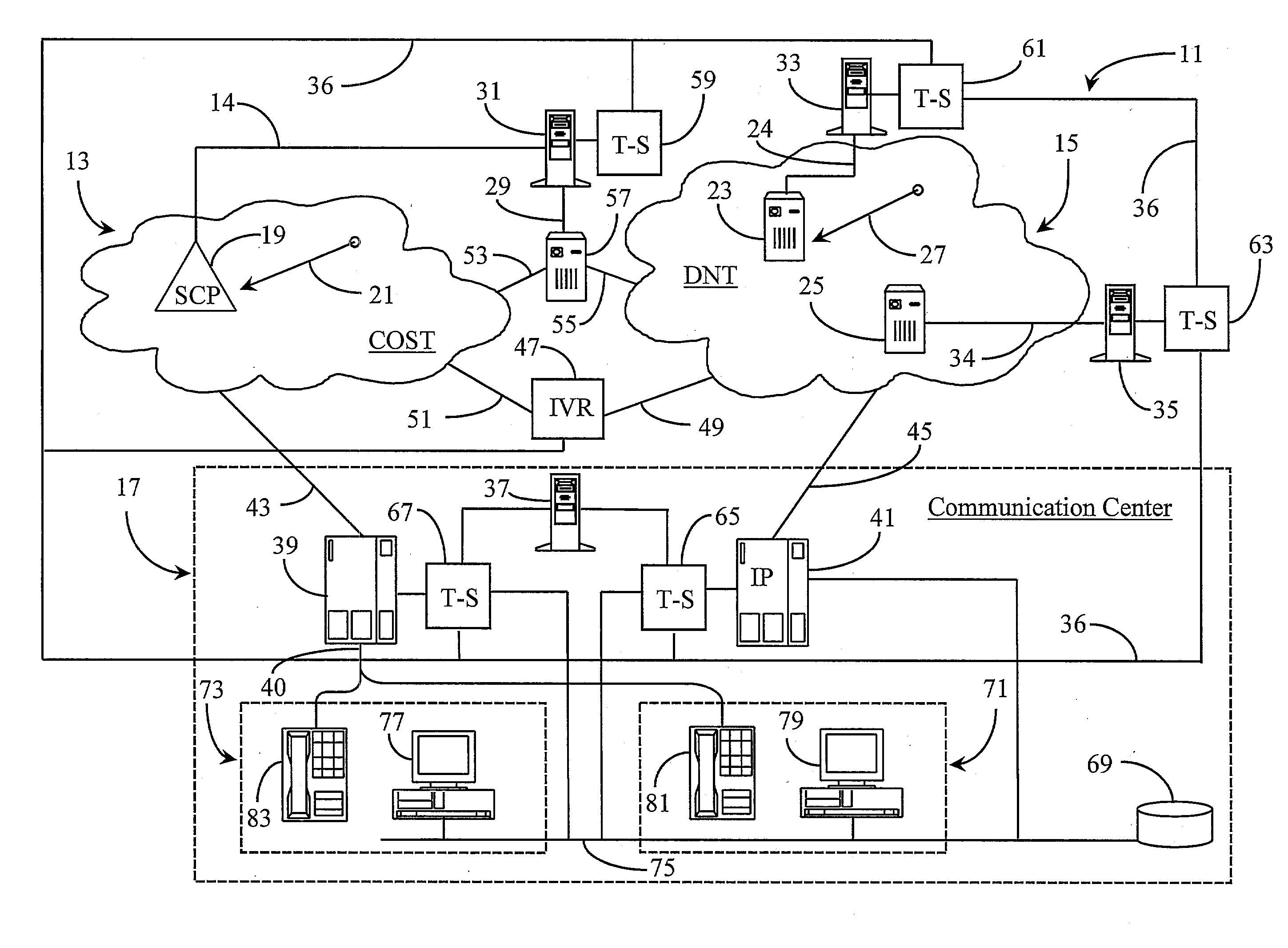

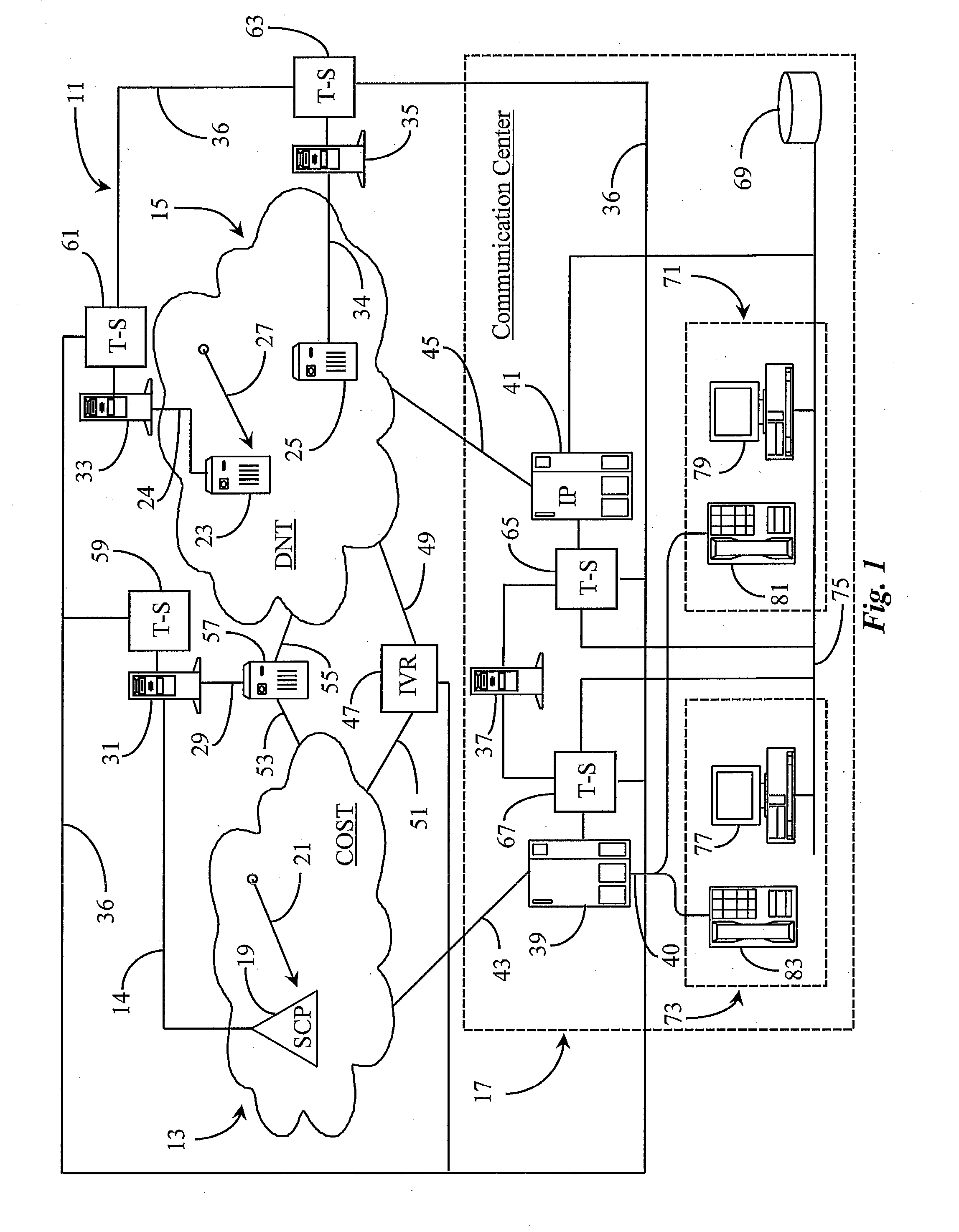

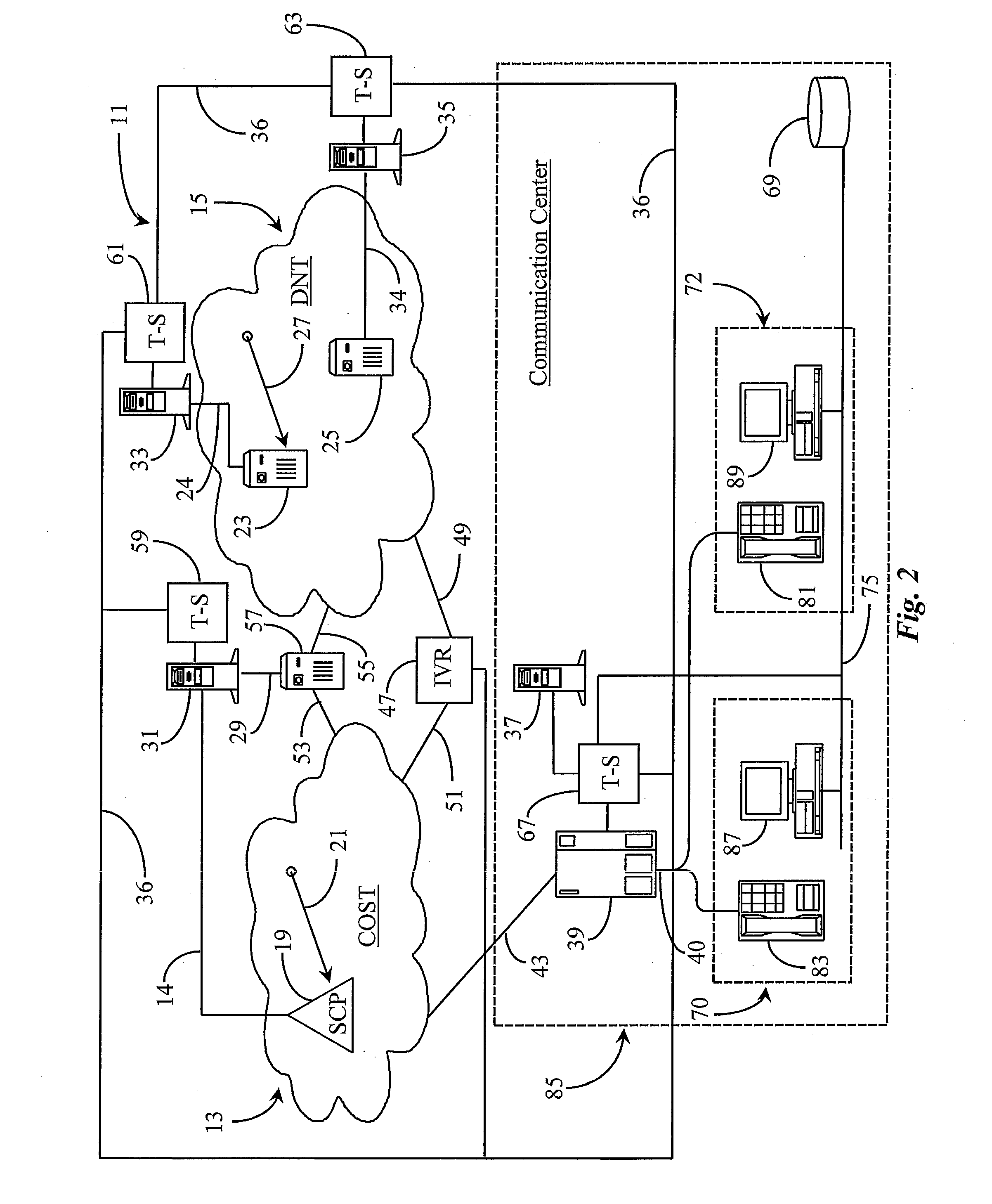

Method for estimating telephony system-queue waiting time in an agent level routing environment

InactiveUS6898190B2Special service provision for substationError preventionComputer telephony integrationNetwork level

A system for estimating call waiting time for a call in a queue takes into account multiple queues wherein agents are shared between queues, abandoned call history, and virtual and priority queues. The system in a preferred embodiment is a computer-telephony integration (CTI) software application adapted to execute on a CTI processor, which may be coupled to switching equipment at network level in a connection-oriented, switched telephony (COST) network or to a switch at call-center level, or both.

Owner:GENESYS TELECOMM LAB INC AS GRANTOR +3

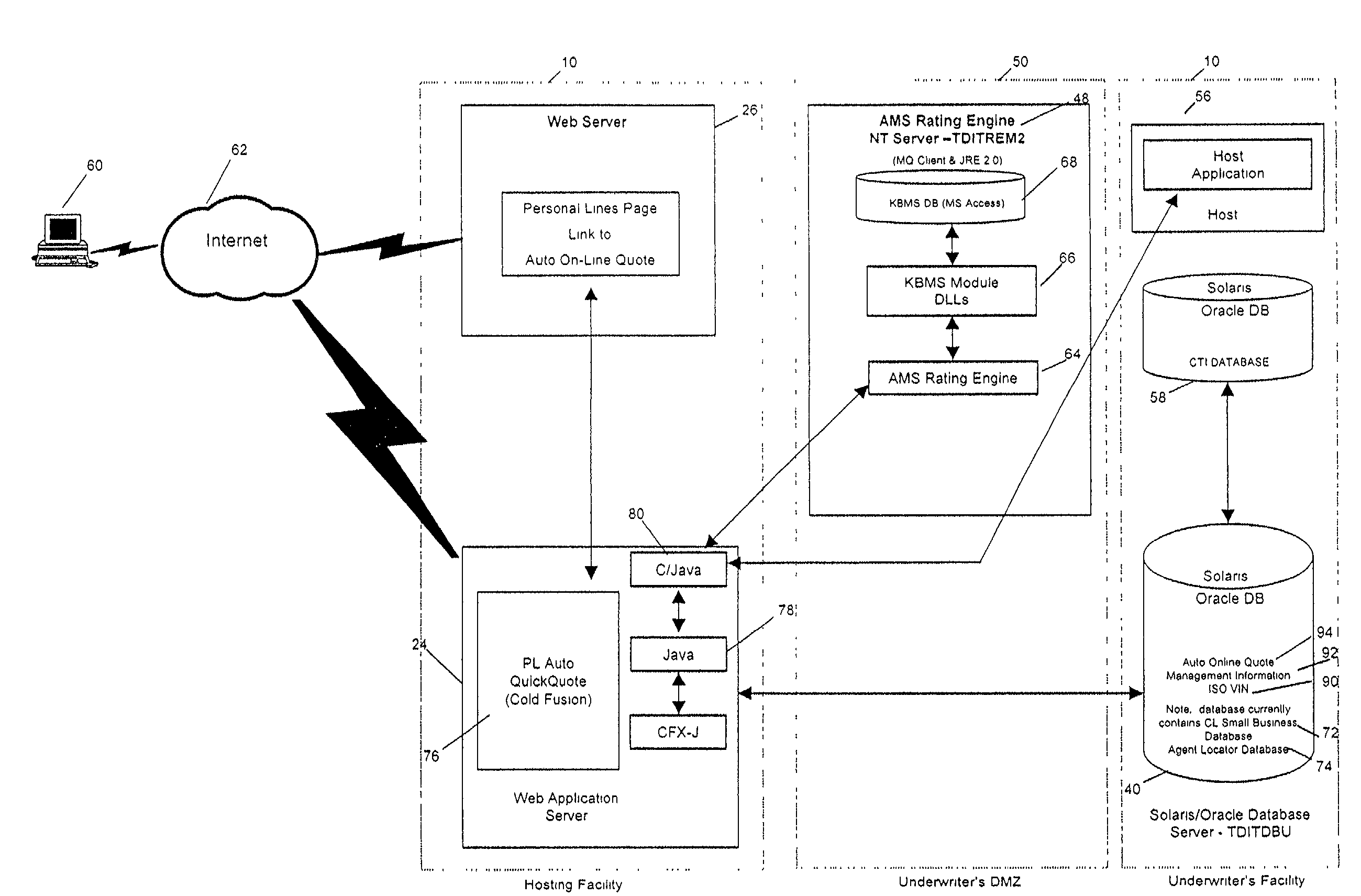

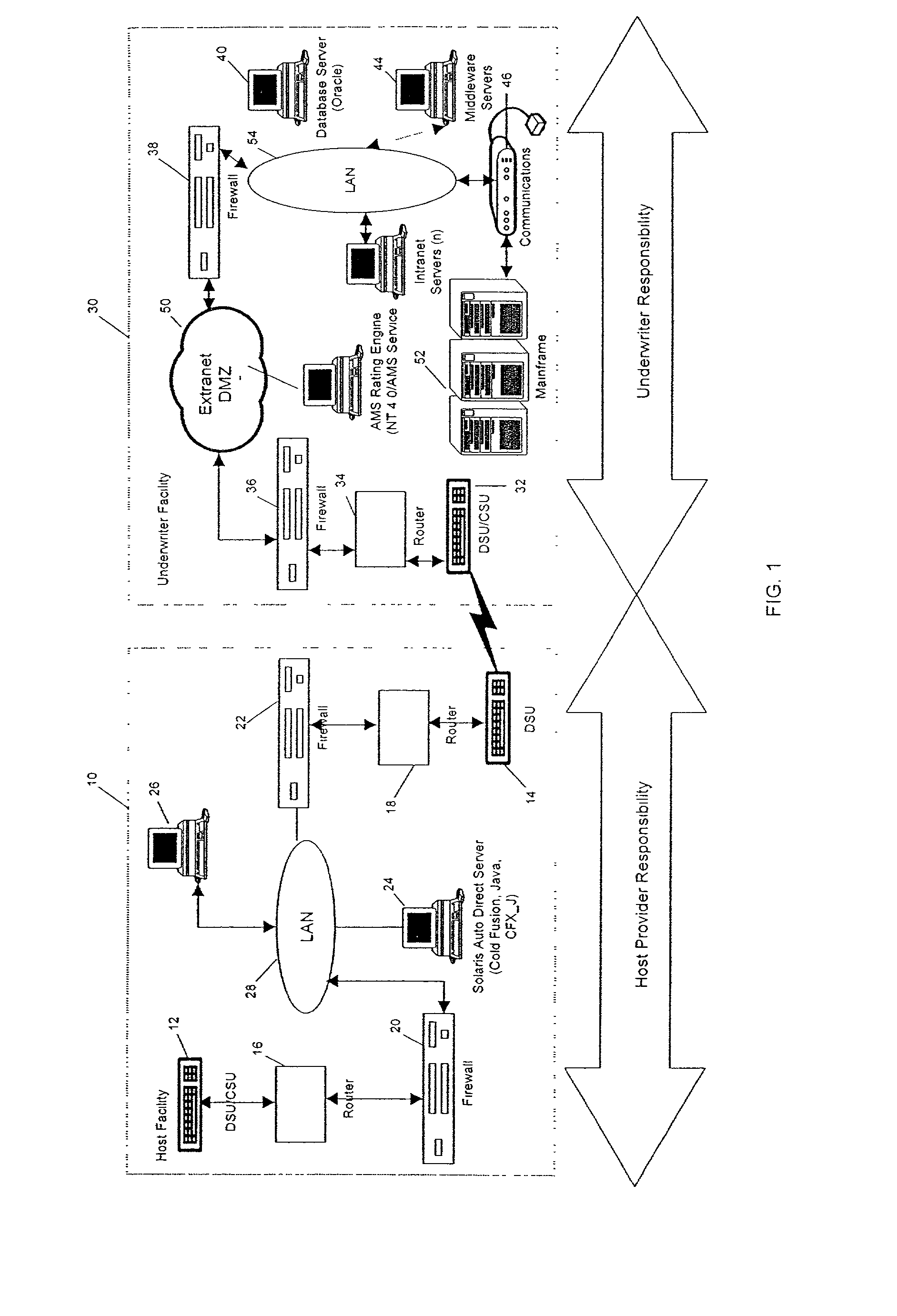

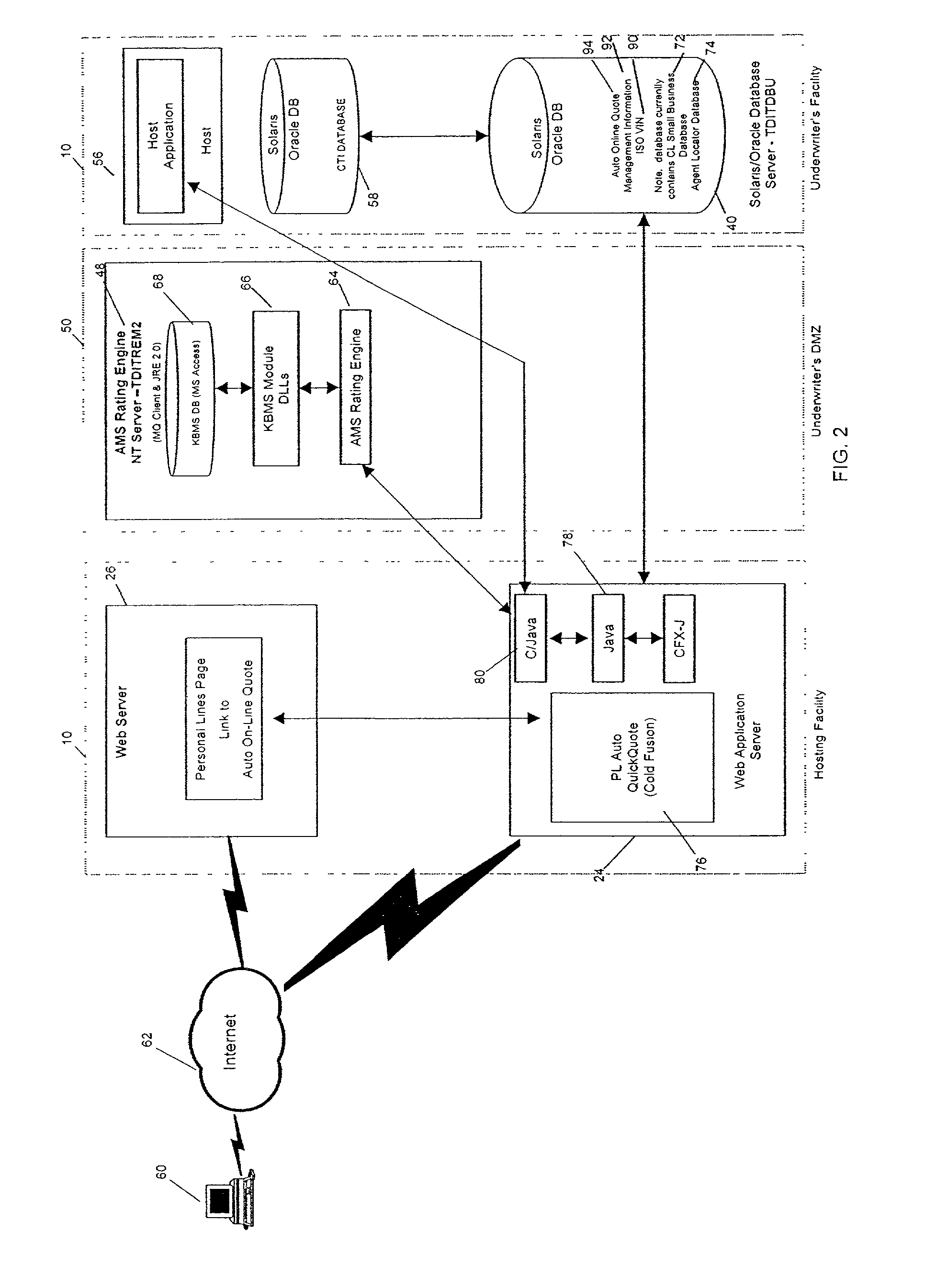

Method and system for furnishing an on-line quote for an insurance product

A method and system for furnishing an on-line quote for an insurance product, such as auto insurance, makes use of computer hardware and software to provide a user with an on-line, real-time quote. The system allows the user to enter user information and recommends coverages, liabilities, and deductibles to help the user determine the best insurance coverage for the user's needs. Upon entering the user data and coverage information on a presentation server, deployable content profile information is retrieved by the presentation server, and a quote is displayed for the user. If the user indicates a continued interest in the quote, a client number is presented to the user and sent to a computer telephony integration database.In an alternate embodiment of the method and system for furnishing an on-line quote for an insurance product, such as auto insurance, the user is allowed to enter basic user information on an on-line quote system application which calls a common data entry system to request credit information for the user. The common data entry system sends the requested credit information to the on-line quote system application, and the user is allowed to enter a selection of coverage using, for example, a coverage wizard feature or a direct-to quote feature. The user is then allowed to enter underwriting information on the on-line quote system application which calls a rating engine of the common data entry system to request rating information. Thereafter, the on-line quote system application displays a quote for the user based at least in part on the rating information, and the user is offered and option to talk to an agent. A fast-forward feature simplifies the entry of modifications for the user.

Owner:THE TRAVELERS INDEMNITY

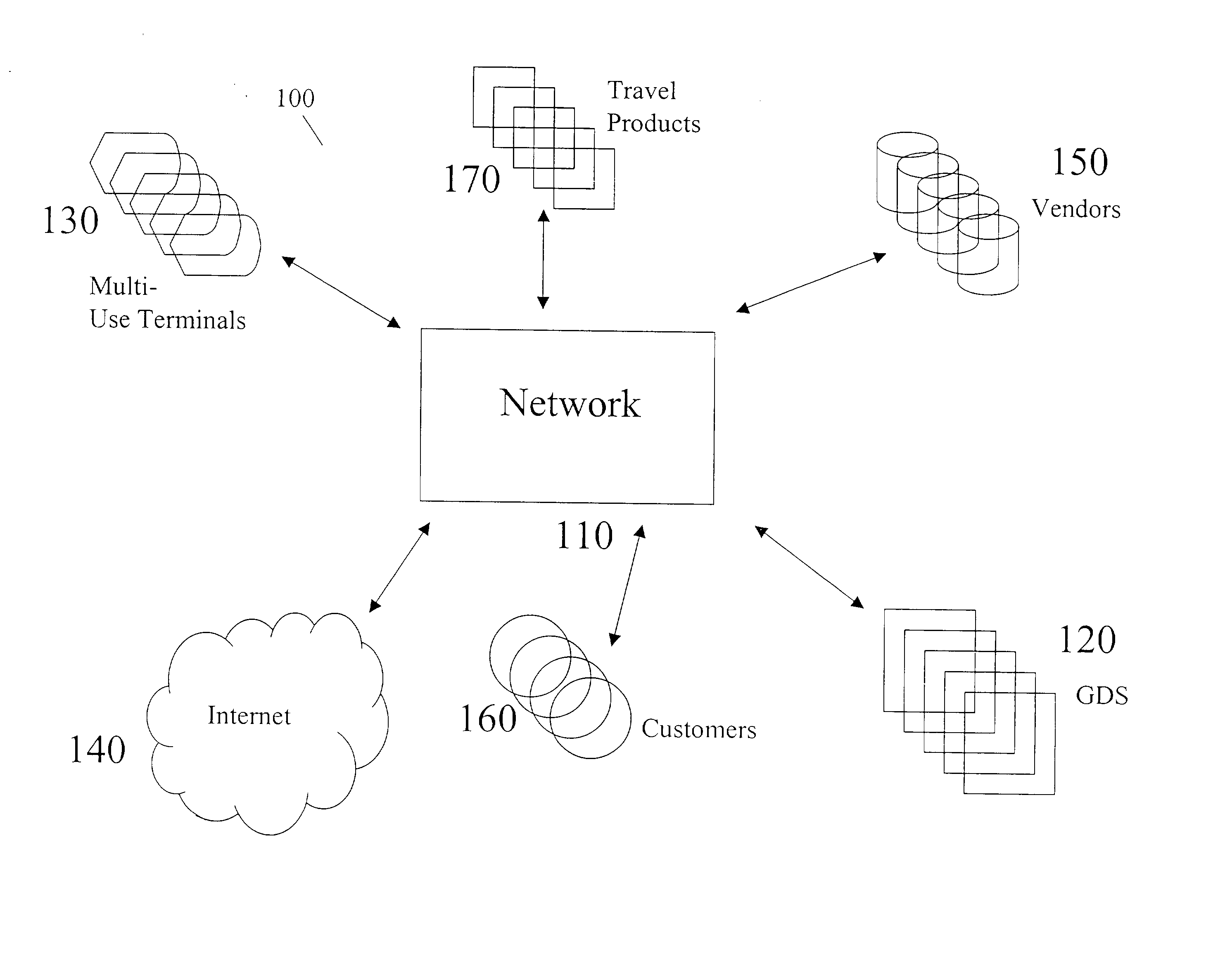

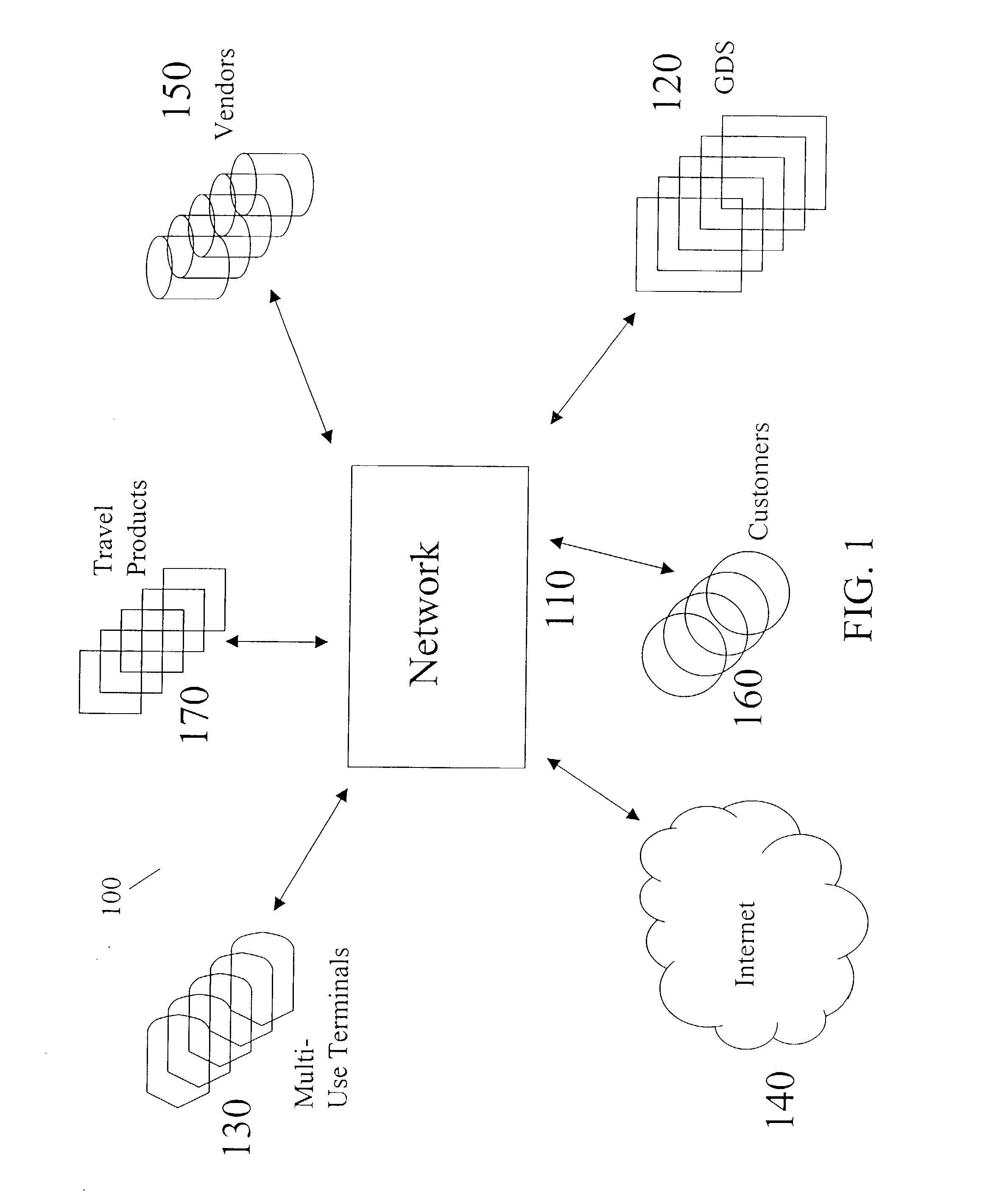

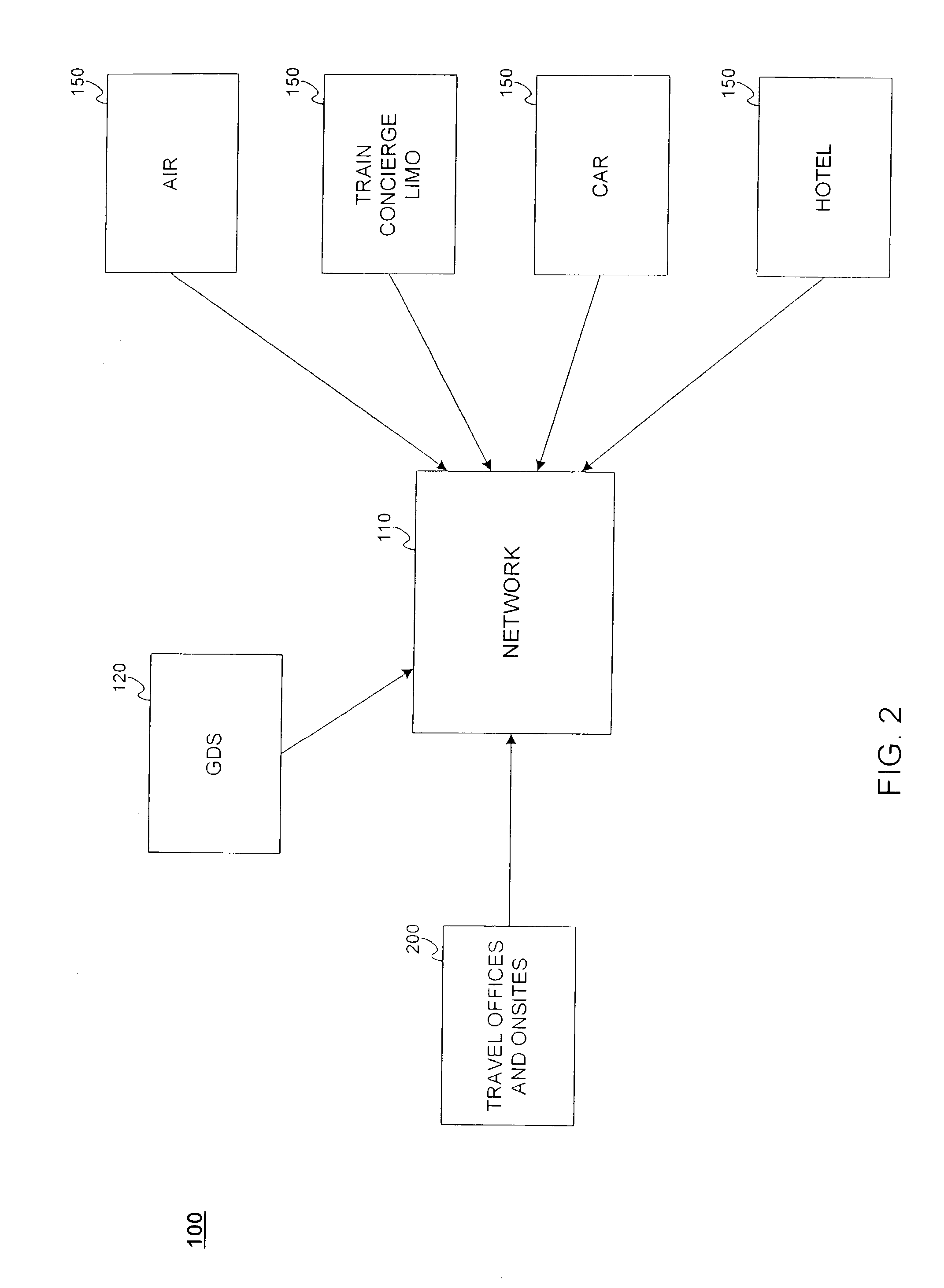

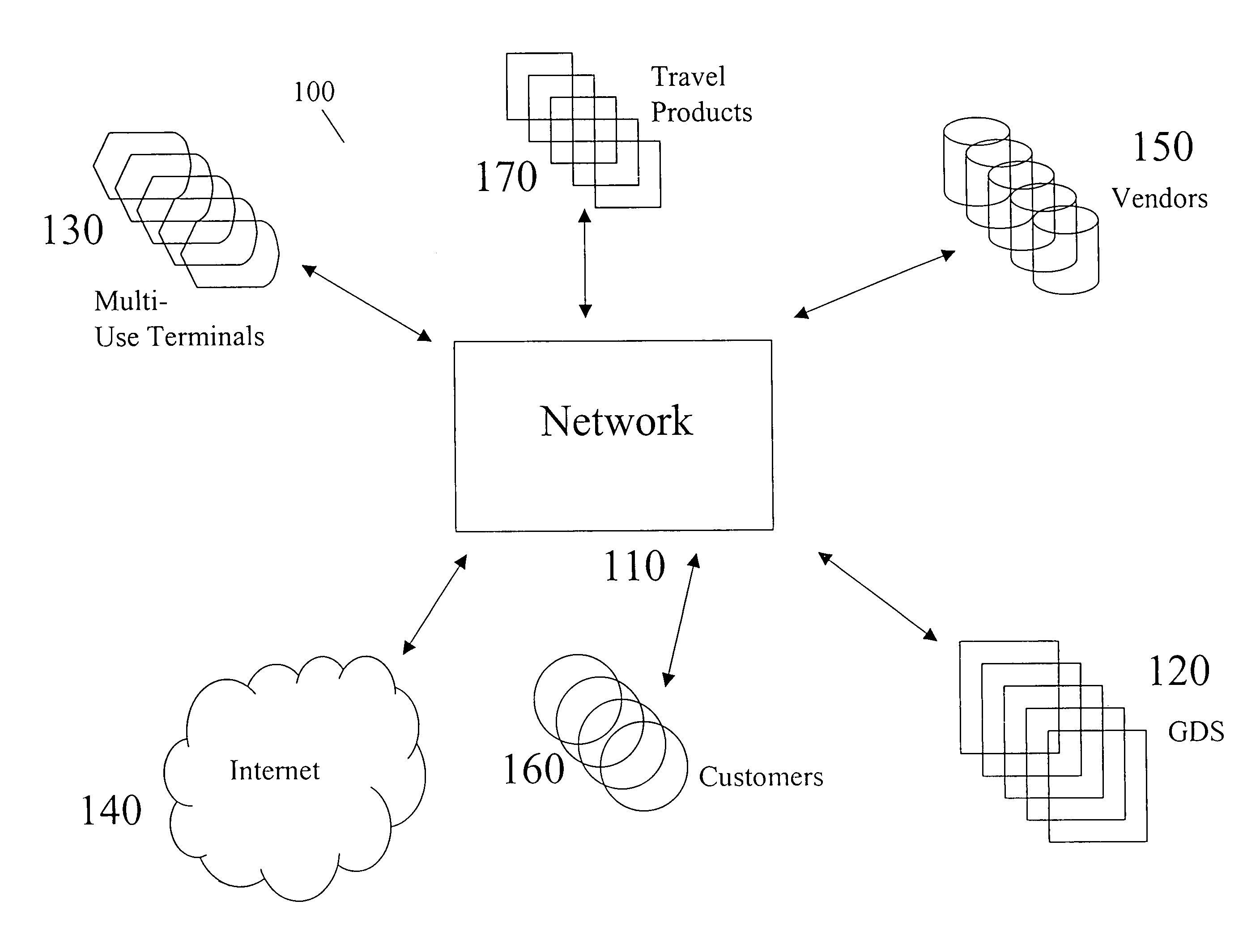

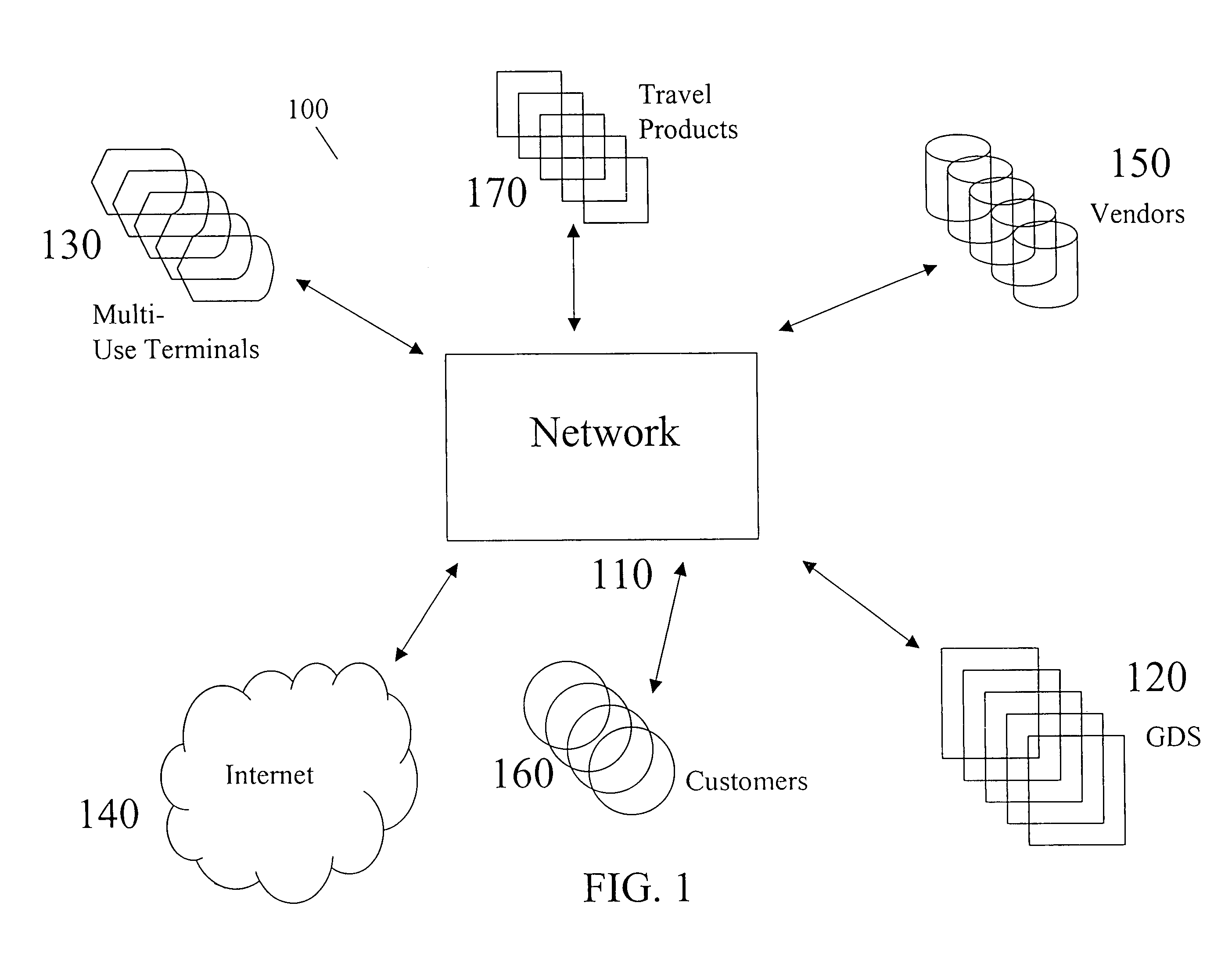

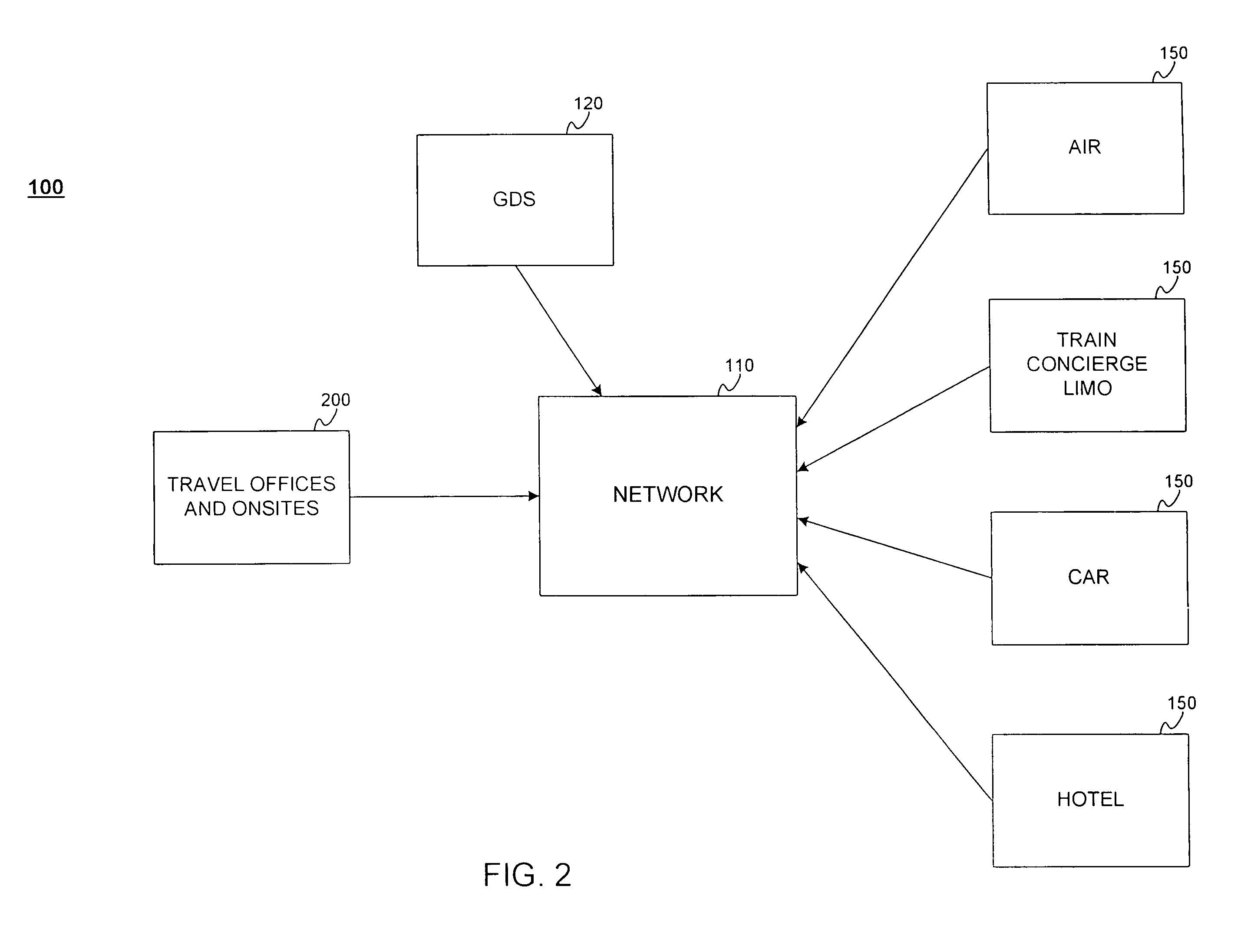

Integrated travel industry system

InactiveUS20030144867A1ReservationsSpecial data processing applicationsCustomer relationship managementPassenger name record

A system and method providing a centralized network for facilitating travel reservations and / or services The system comprises a network with hub sites that provide a centralized connection for Global Distribution Systems / Computer Reservation Systems, travel vendors, and travel office point of service terminals The travel office point of service terminals provide a plurality of modules for various travel related applications such as a low fare search module, a computer telephony integration module, a super passenger name record database, a customer database, a trip planning module, a customer relationship management module, a workflow module, and an integrated e-mail booking system.

Owner:LIBERTY PEAK VENTURES LLC

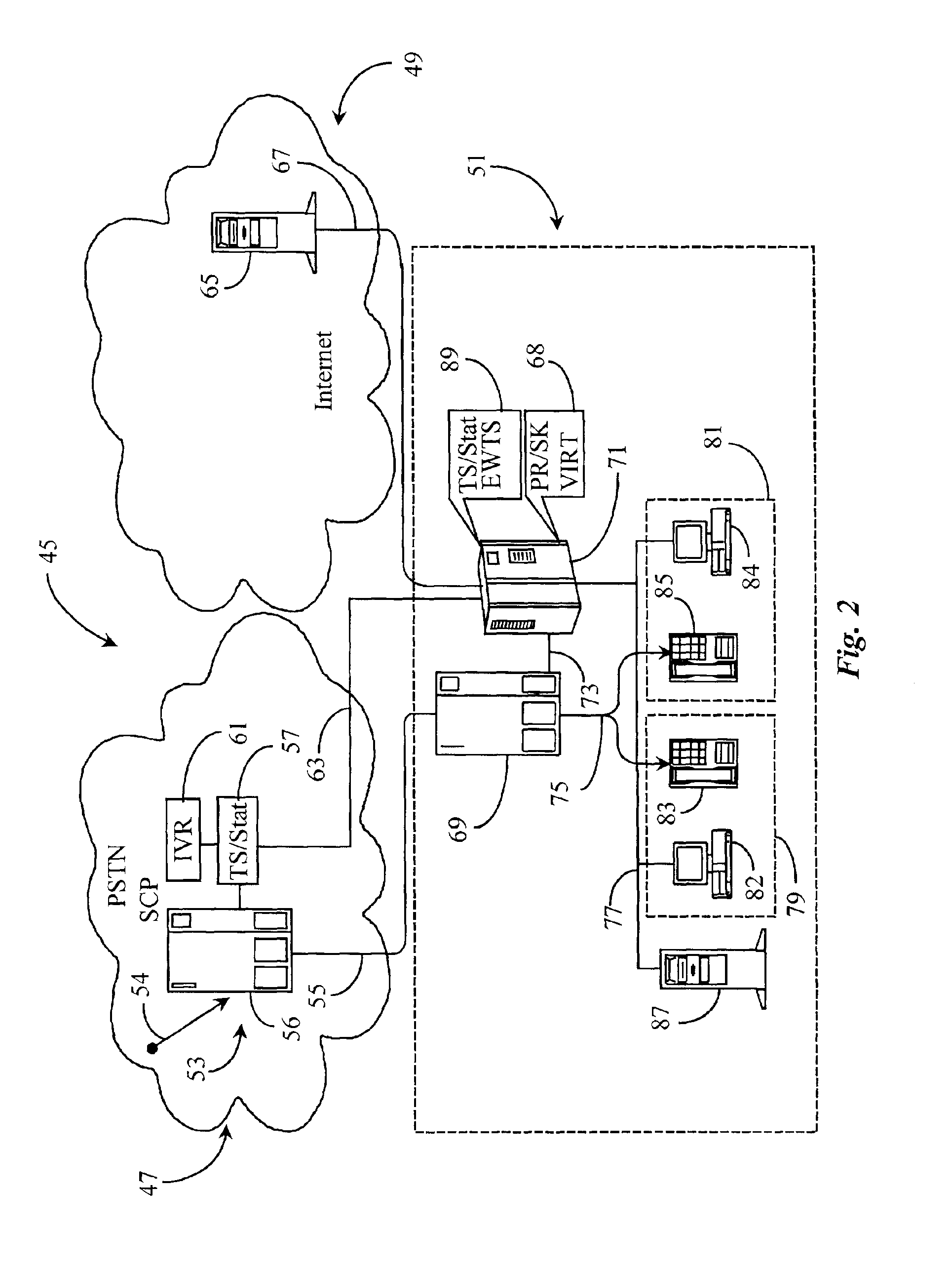

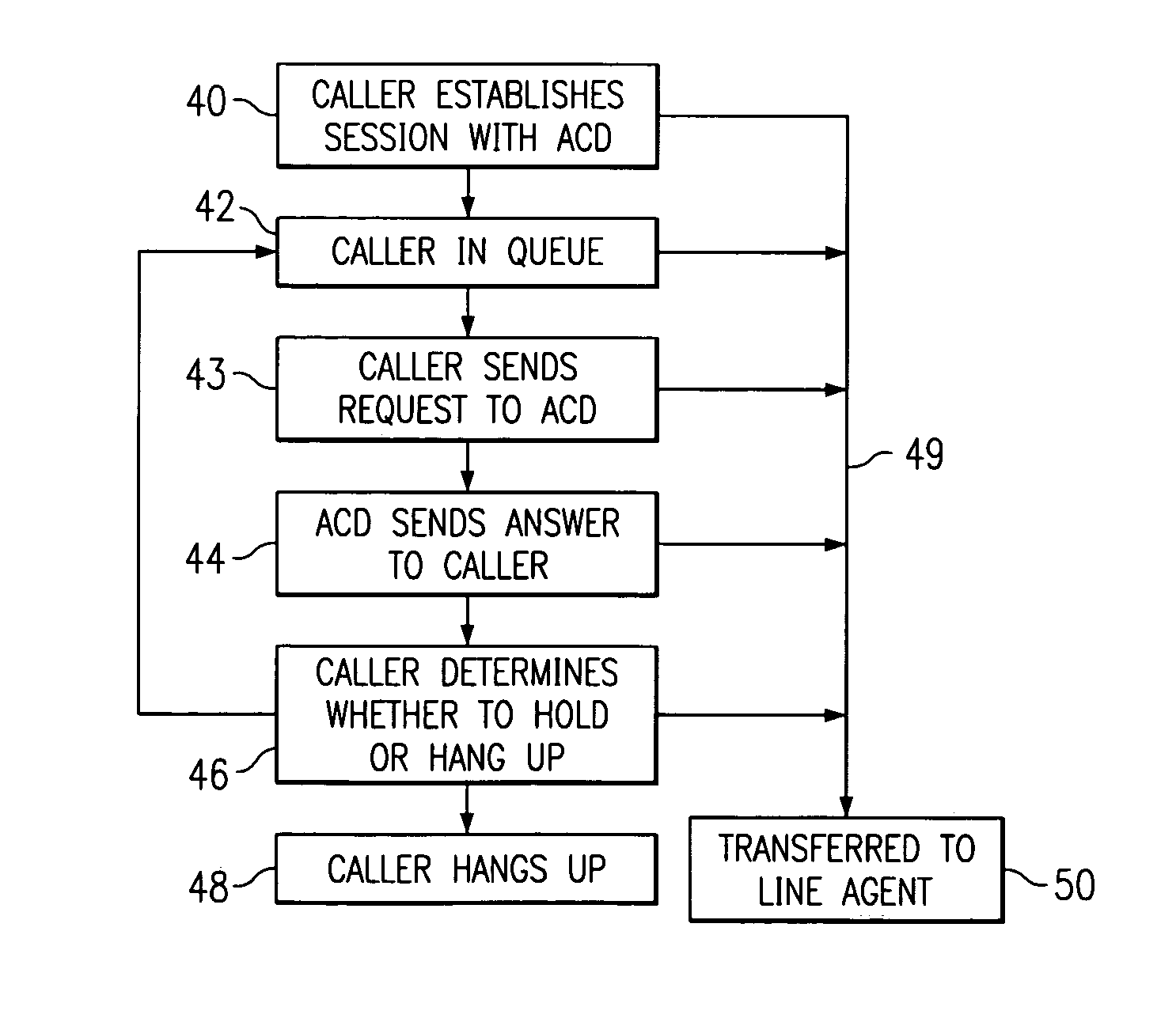

System and method for dynamic queuing in an automatic call distributor

InactiveUS7233980B1Reduce frustrationImprove customer satisfactionSpecial service for subscribersMultiple digital computer combinationsSignaling protocolDistributor

A method and system for dynamic queuing utilizes a SIP messaging structure within a call center's architecture for interacting with a caller. The method and system can be used for ACD services developed for IP telephony using SIP as the signaling protocol. A SIP subscriber can also interact with an ACD system in the Public Switched Telephone Network (PSTN) work space. In the latter case, a PSTN-to-IP gateway carries the bearer path and call level signaling between the two spaces, and corresponding Computer Telephony Integration (CTI) signaling links are used for linking the ACD specific signaling between the two spaces.

Owner:GENBAND US LLC

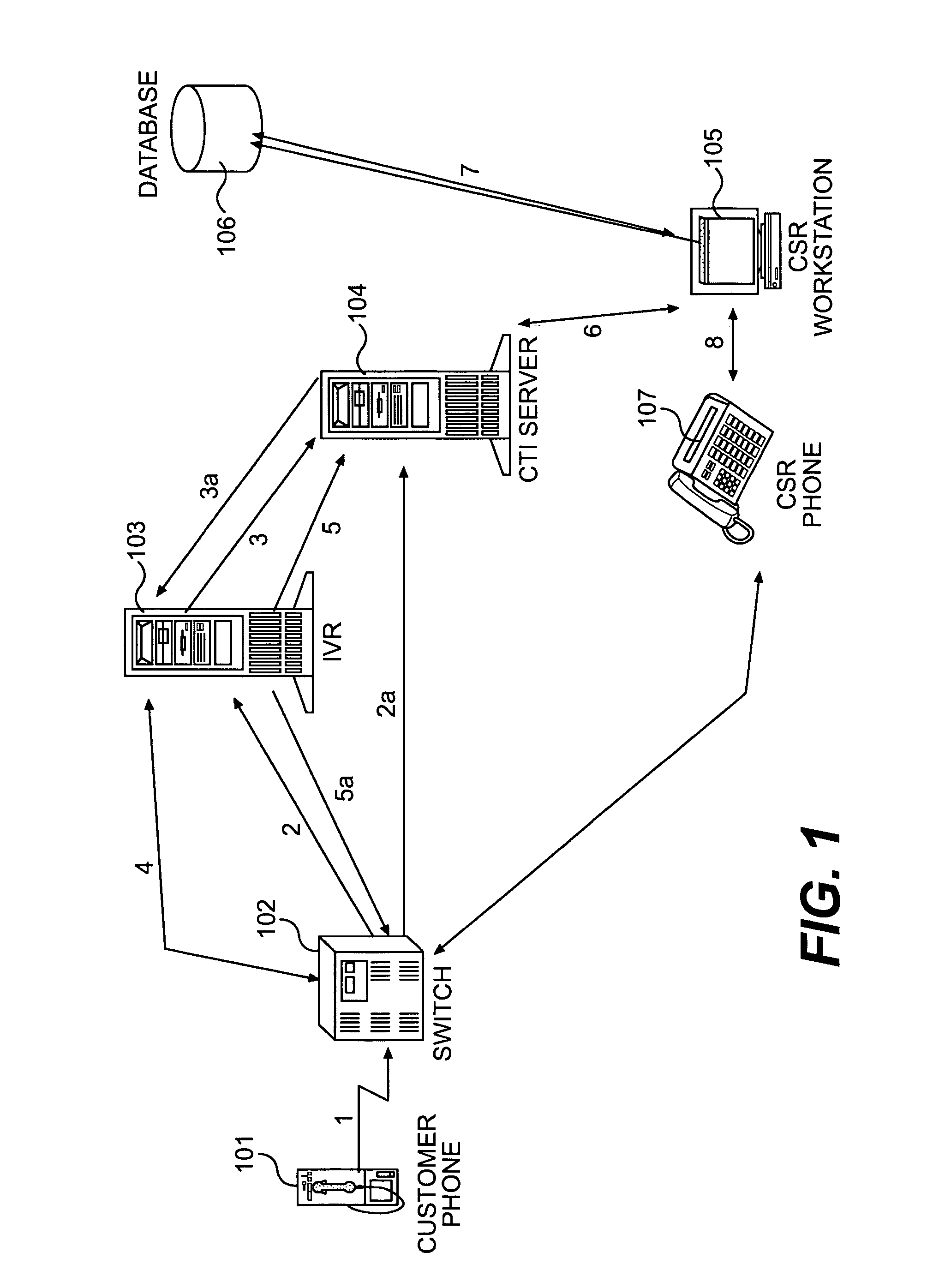

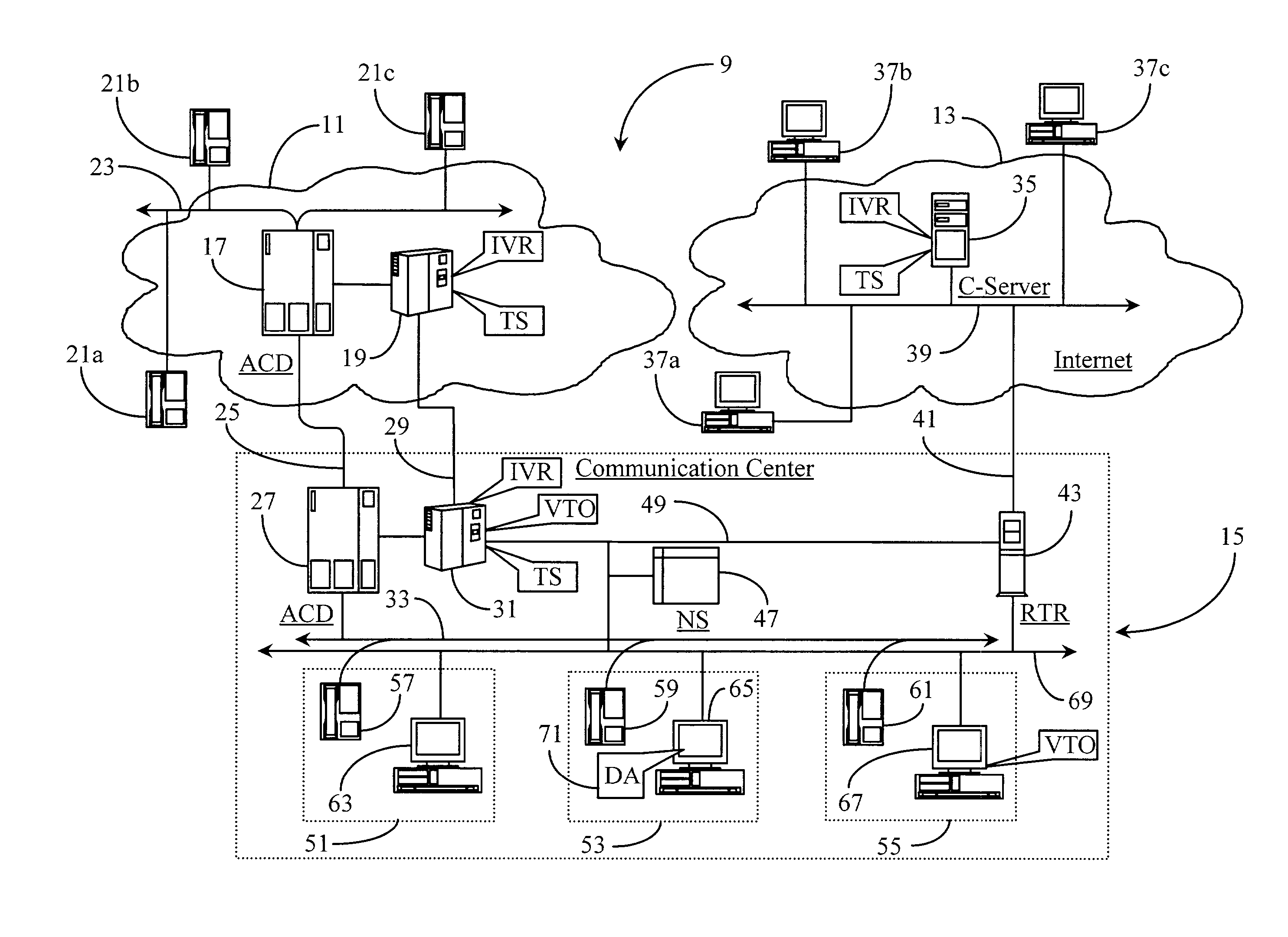

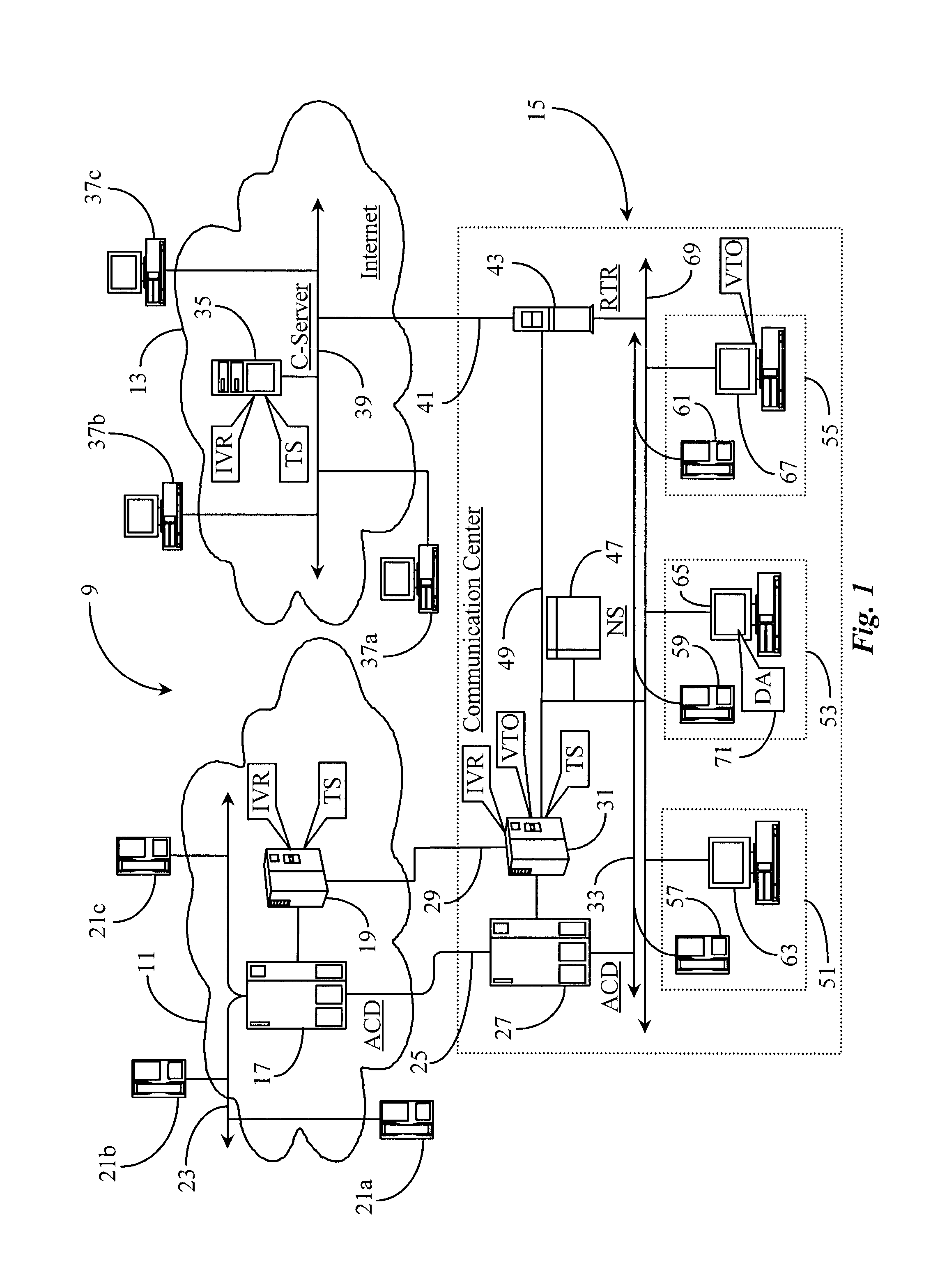

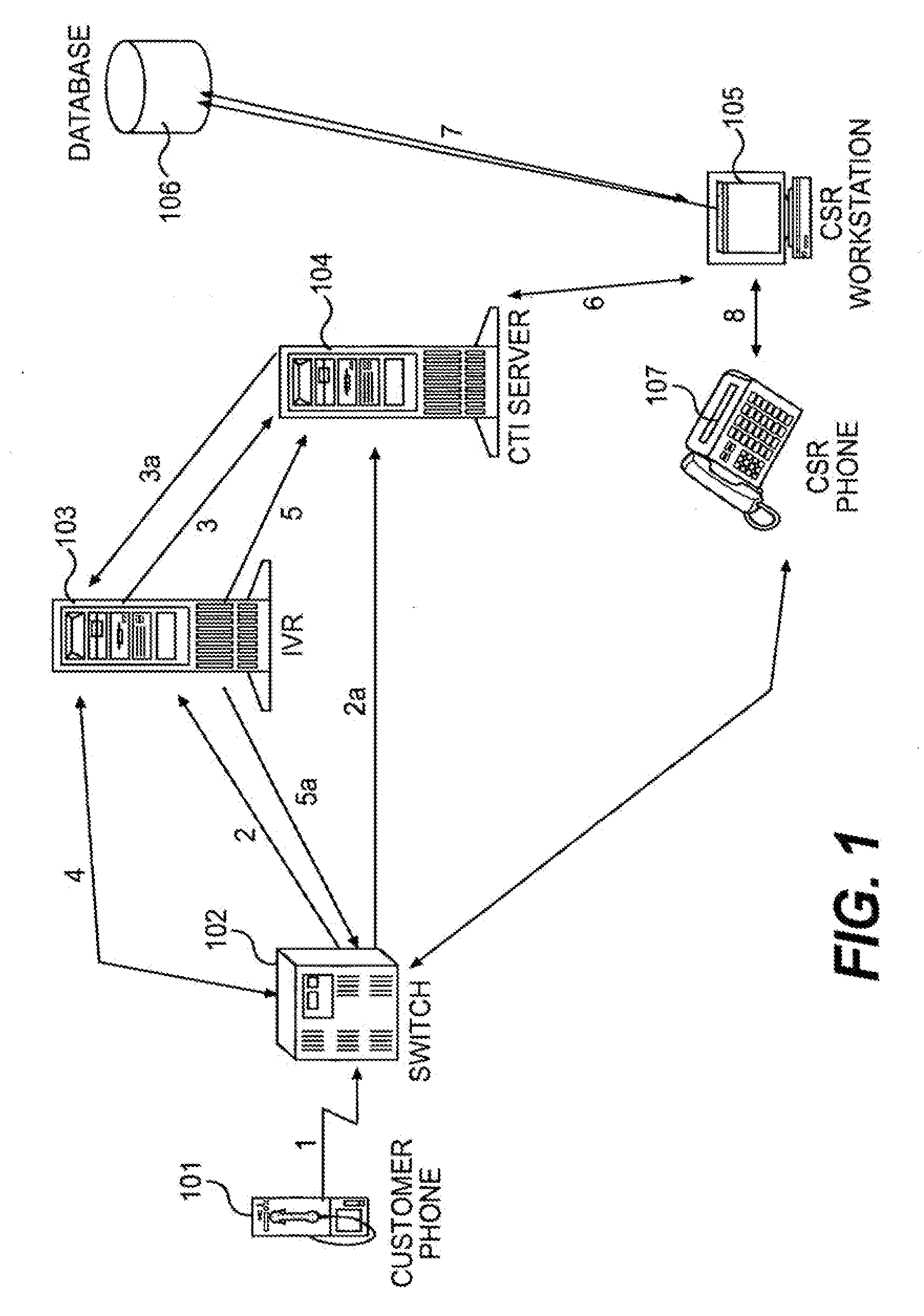

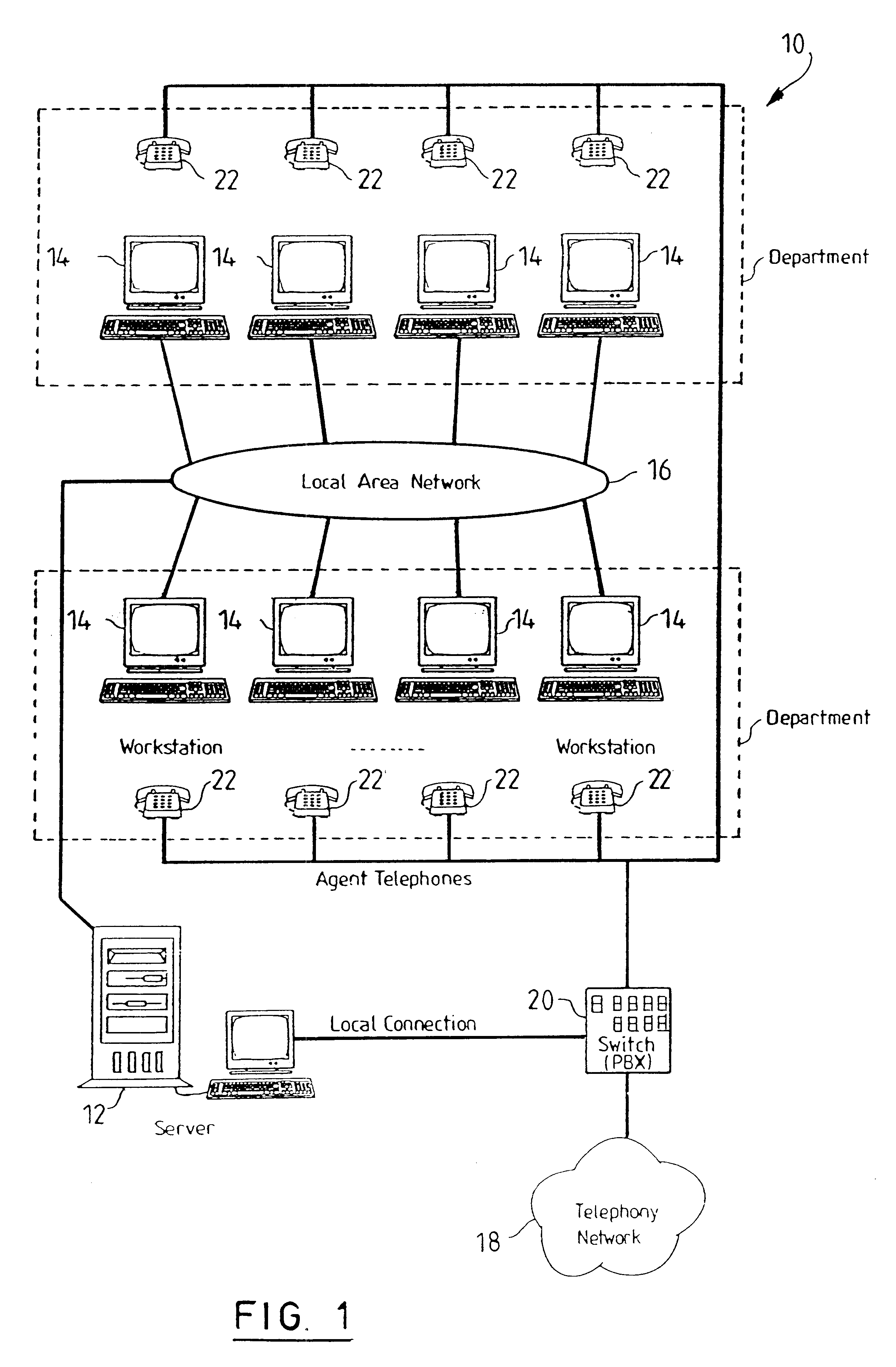

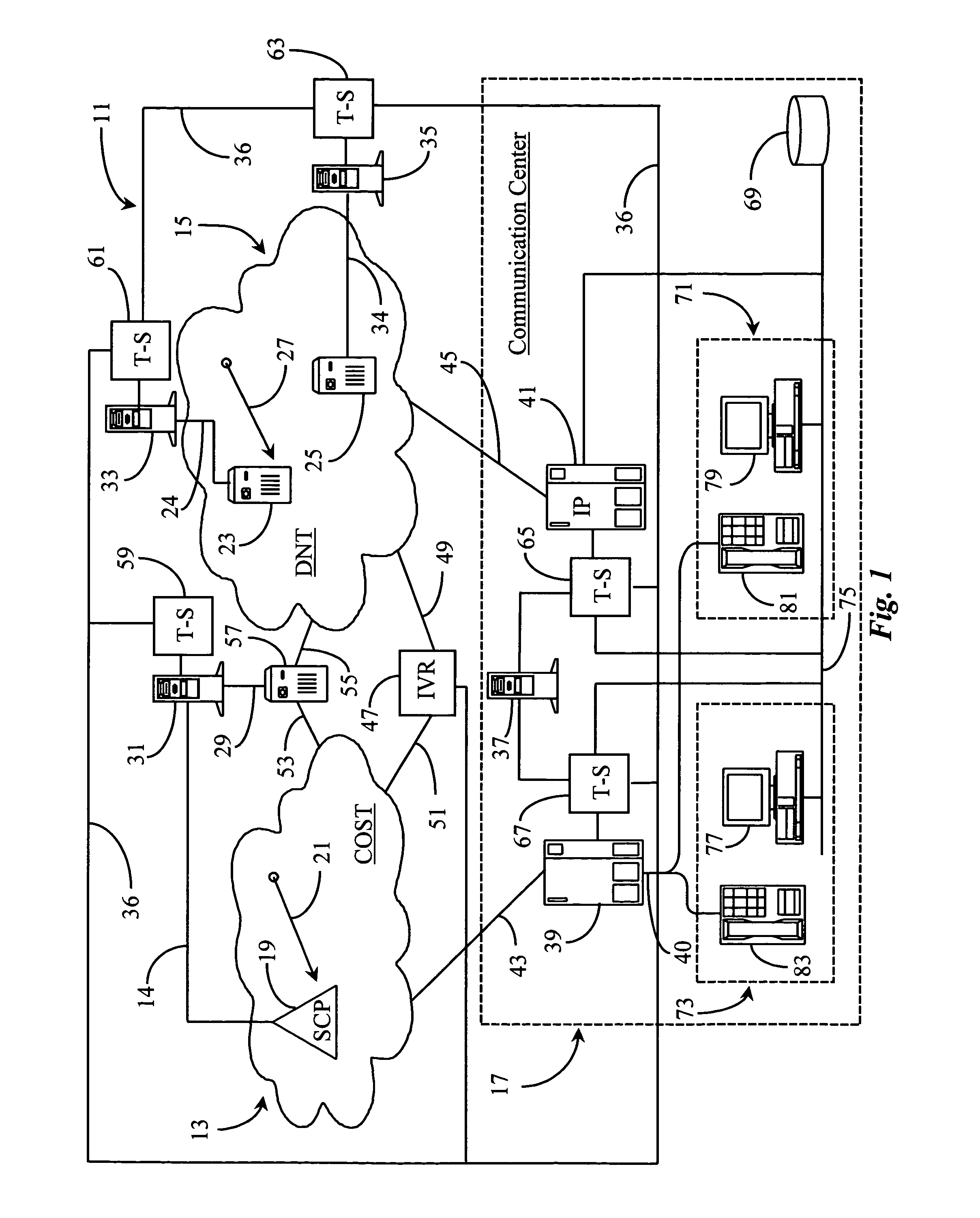

Call and data correspondence in a call-in center employing virtual restructuring for computer telephony integrated functionality

InactiveUS6735298B2Multiplex system selection arrangementsSpecial service provision for substationApplication programming interfaceApplication software

A call center having agent stations comprising telephones connected to computer stations by a Telephone Application Programming Interface (TAPI)-compliant bridge has data pertaining to callers stored in a database on a local area network (LAN) to which the computer stations are also connected. Origination data for incoming calls, both conventional calls to the telephones and computer-simulated calls to the computer platforms, is used as a key to extract data pertaining to calls from the database for display on video display units (VDUs) of the computer workstations where the calls are terminated. In some cases, data is only extracted and displayed for calls from previously listed origination points.

Owner:GENESYS TELECOMM LAB INC AS GRANTOR +3

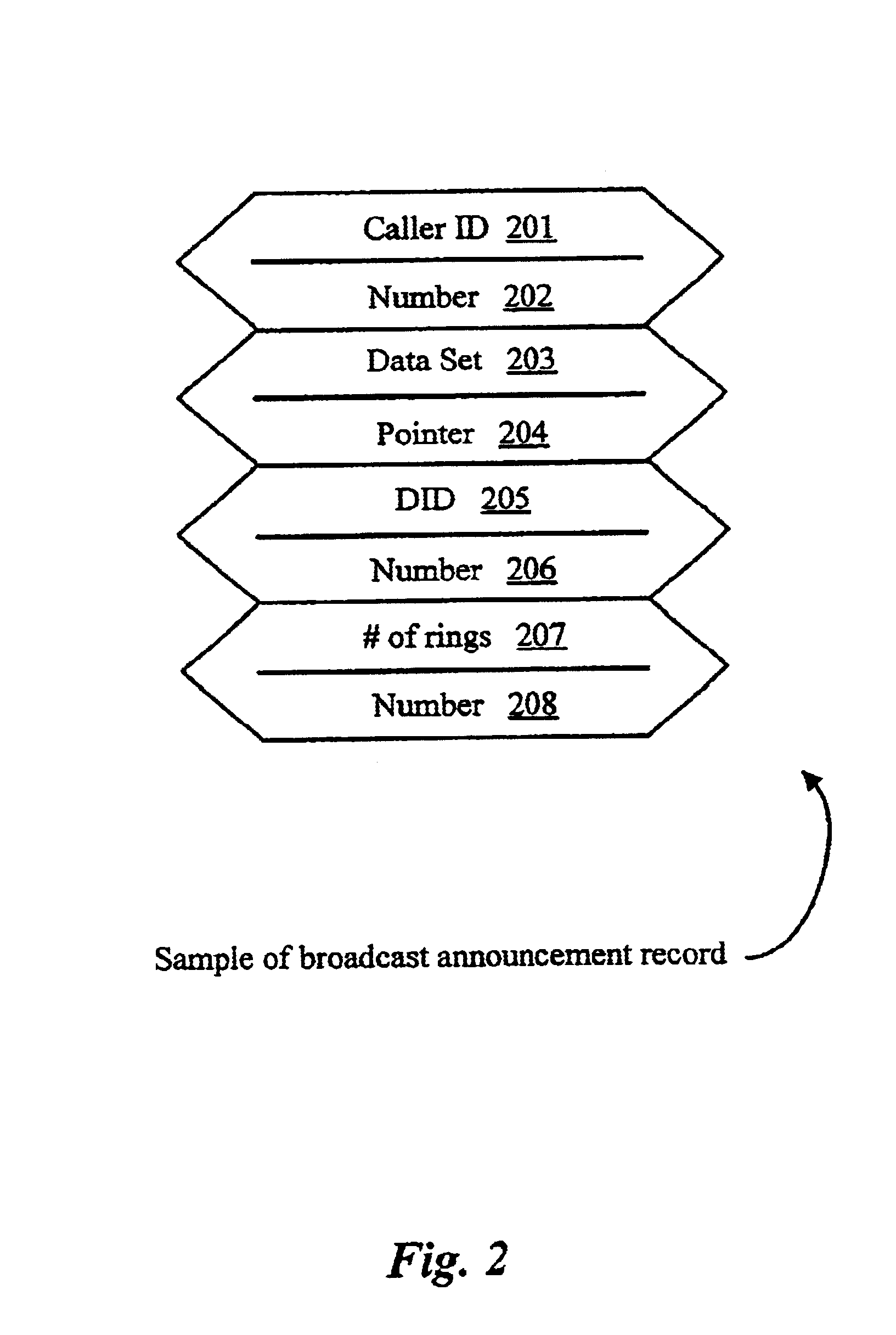

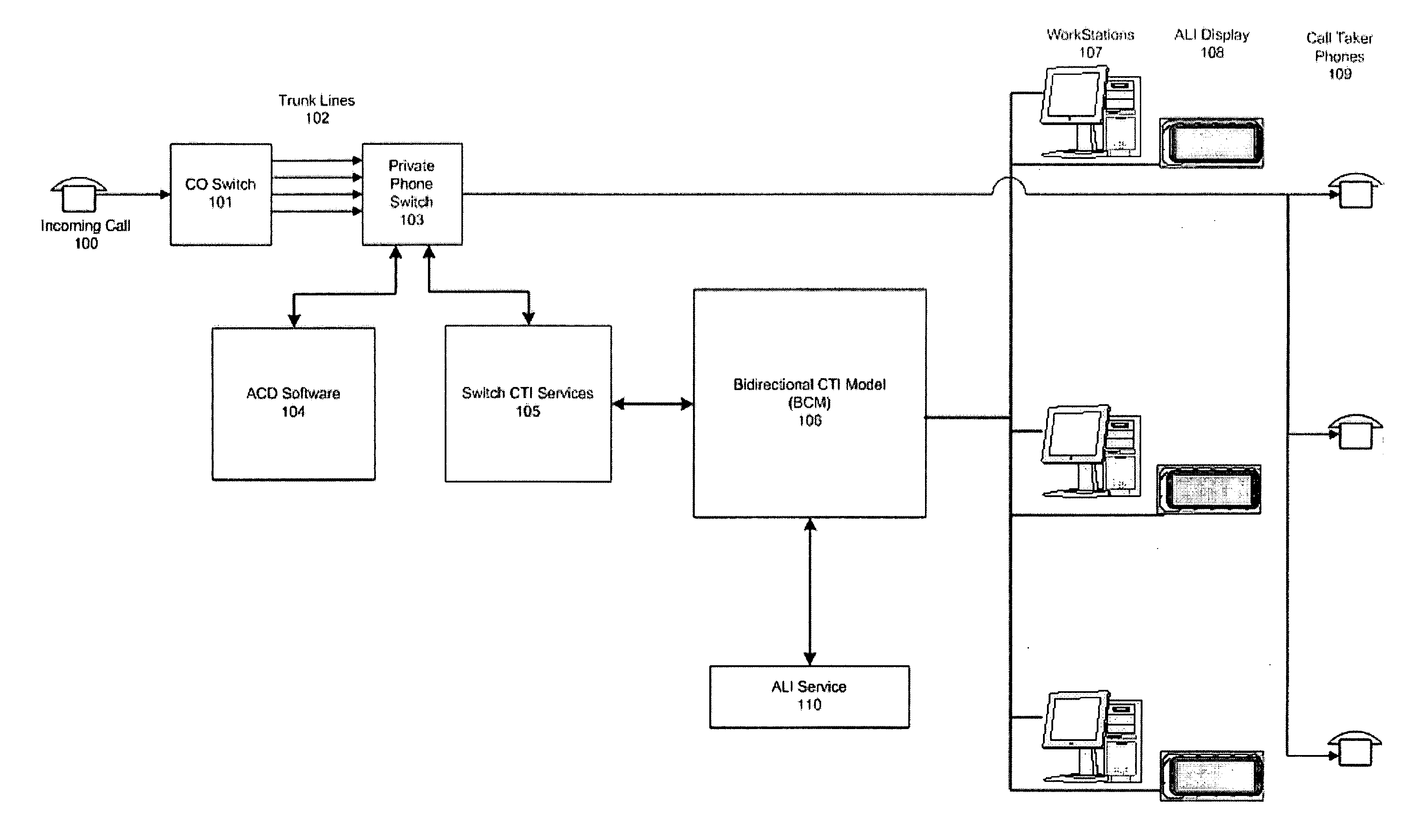

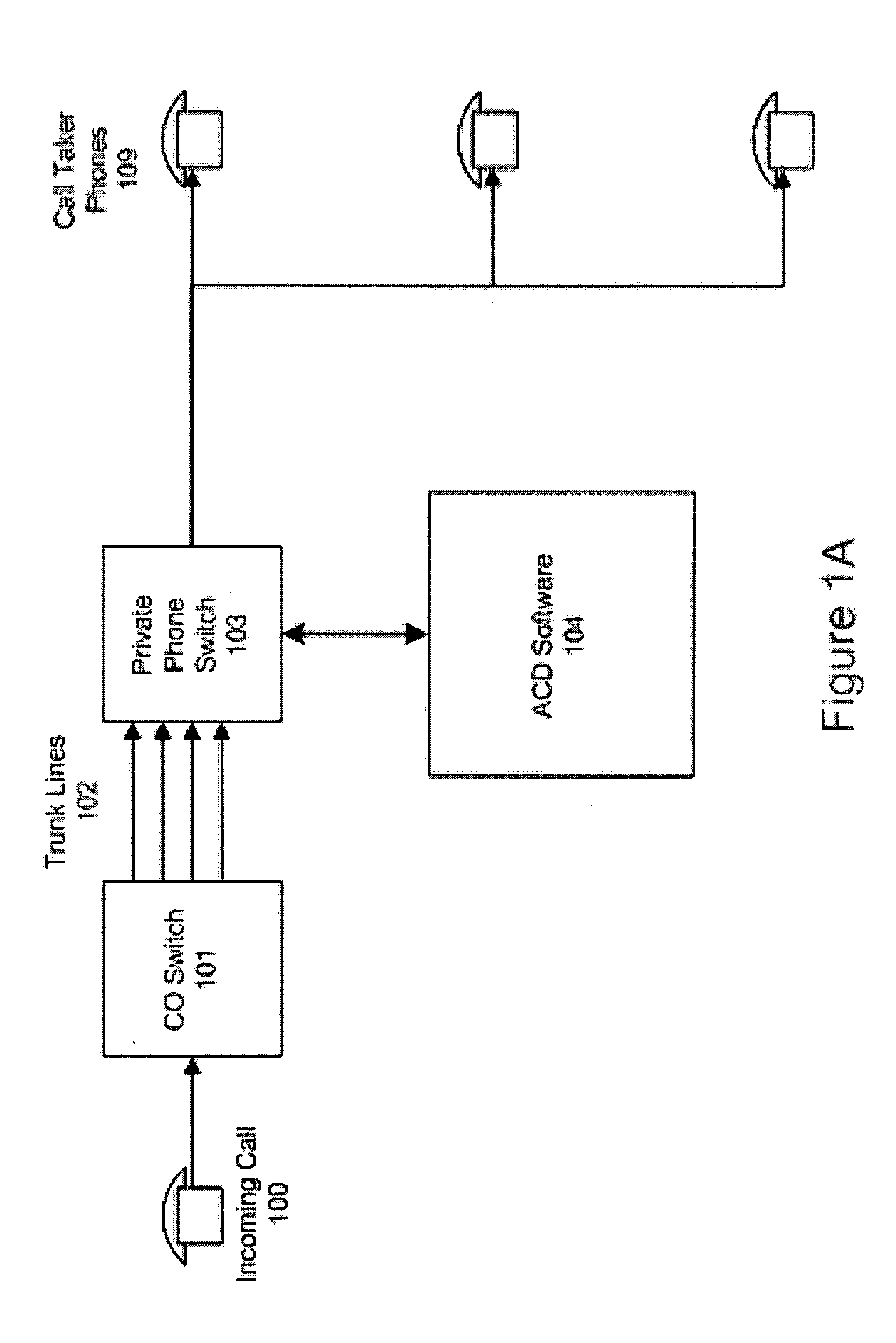

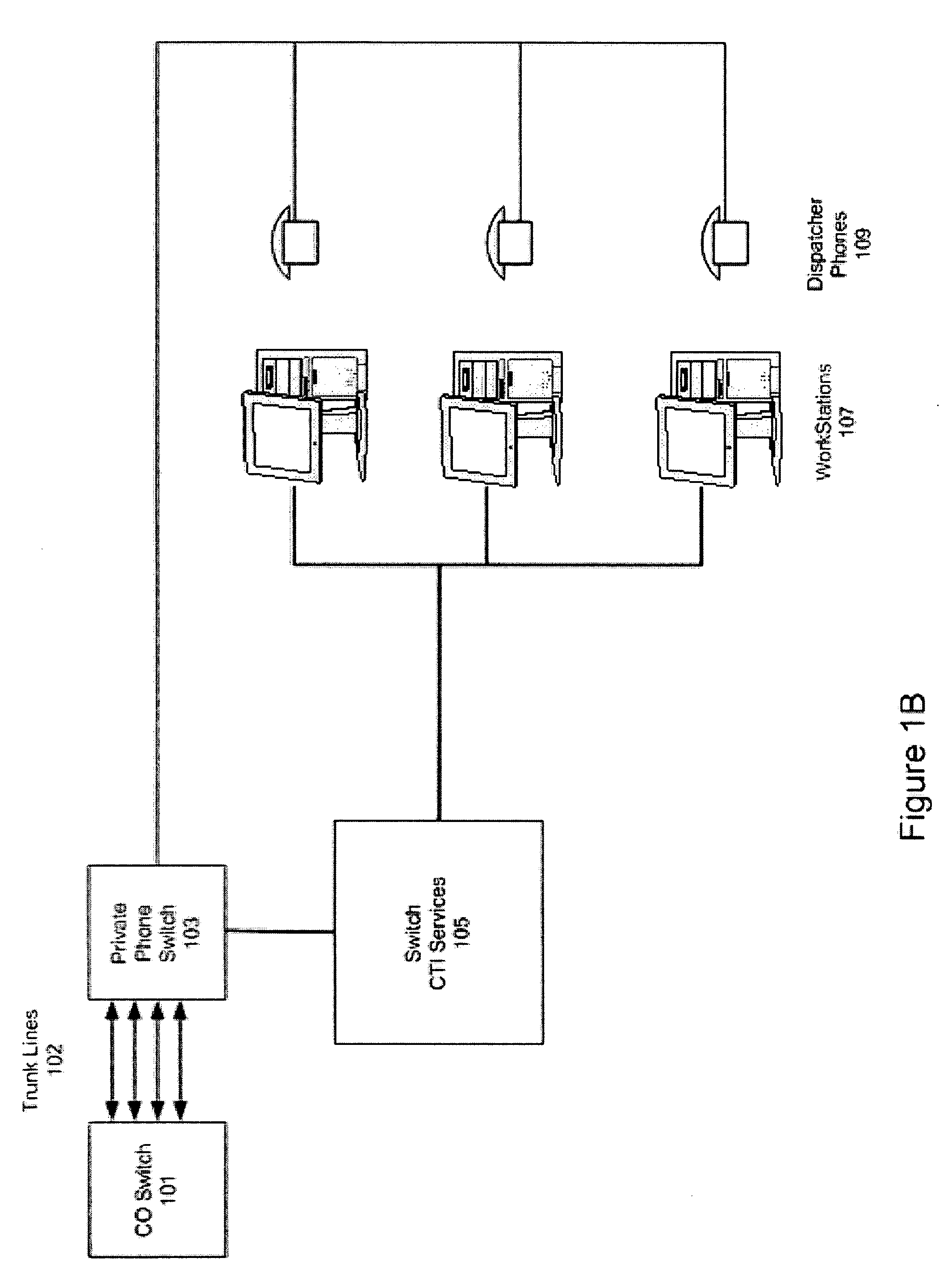

Computer-telephony integration (CTI) system for controlling an automatic call distribution system using a bidirectional CTI model

A Computer-Telephony Integration (CTI) system is used to control an Automatic Call Distribution (ACD) system, and non-ACD phone functions, where all functions can be performed at either the phone or the computer display by creating a Bidirectional CTI Model (BCM) in software. The ACD system is used in call centers to route incoming calls to call takers according to attributes such as dispatcher skill-sets or time since last call received. The ACD system is also able to send a call to a dispatcher without ringing, using an auto-answer system. The CTI system allows telephone functions such as originating calls, answering calls, and hold, transfer, and conference features to be controlled by a computer workstation.

Owner:NINE ONE ONE

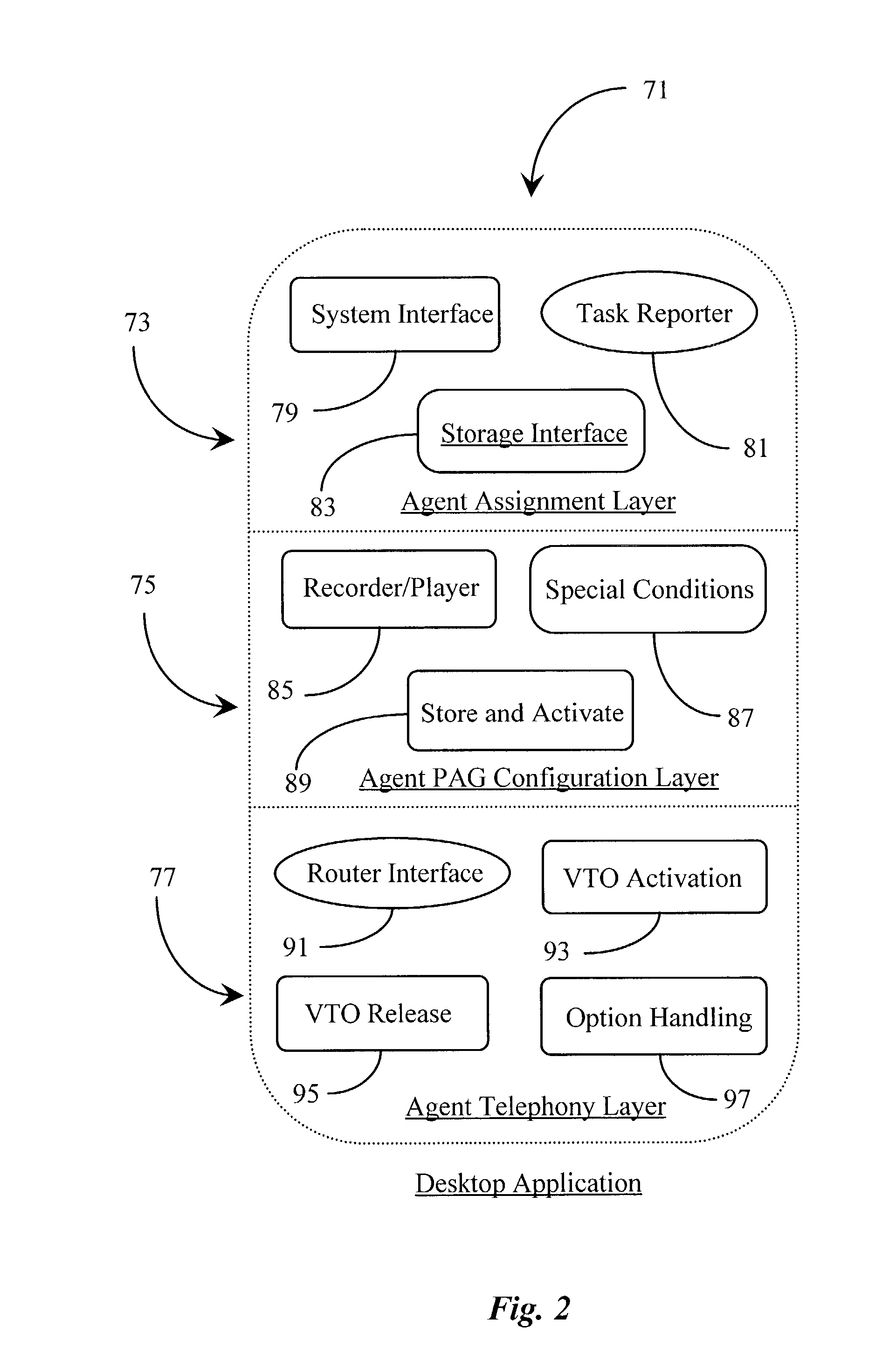

Method and apparatus for recording and automated playback of personal agent greetings in a communication-center environment

InactiveUS7006607B2Automatic call-answering/message-recording/conversation-recordingSpecial service for subscribersThe InternetCall routing

A system for presenting a recorded message on behalf of an agent receiving a call at an agent station in a call center, the agent station having a telephony interface for receiving calls and a personal computer with a video display unit (PC / VDU), has a telephony switching apparatus enhanced by a computer-telephony integration (CTI) processor, an Interactive Voice Response (IVR) system executing a voice treatment option (VTO) software, coupled to the telephony switching apparatus and the CTI processor; and a data repository having recorded messages stored on behalf of the agent and accessible to the CTI processor. The CTI processor routes incoming calls to the telephony interface for the agent, uses data associated with the calls for selecting appropriate recorded messages, and causes, by controlling the IVR, a retrieved recorded message to be played to a caller upon the agent picking up the routed call. The system is useful with both conventional telephone systems and data network telephony, such as over the Internet.

Owner:GENESYS TELECOMMUNICATIONS LABORATORIES INC

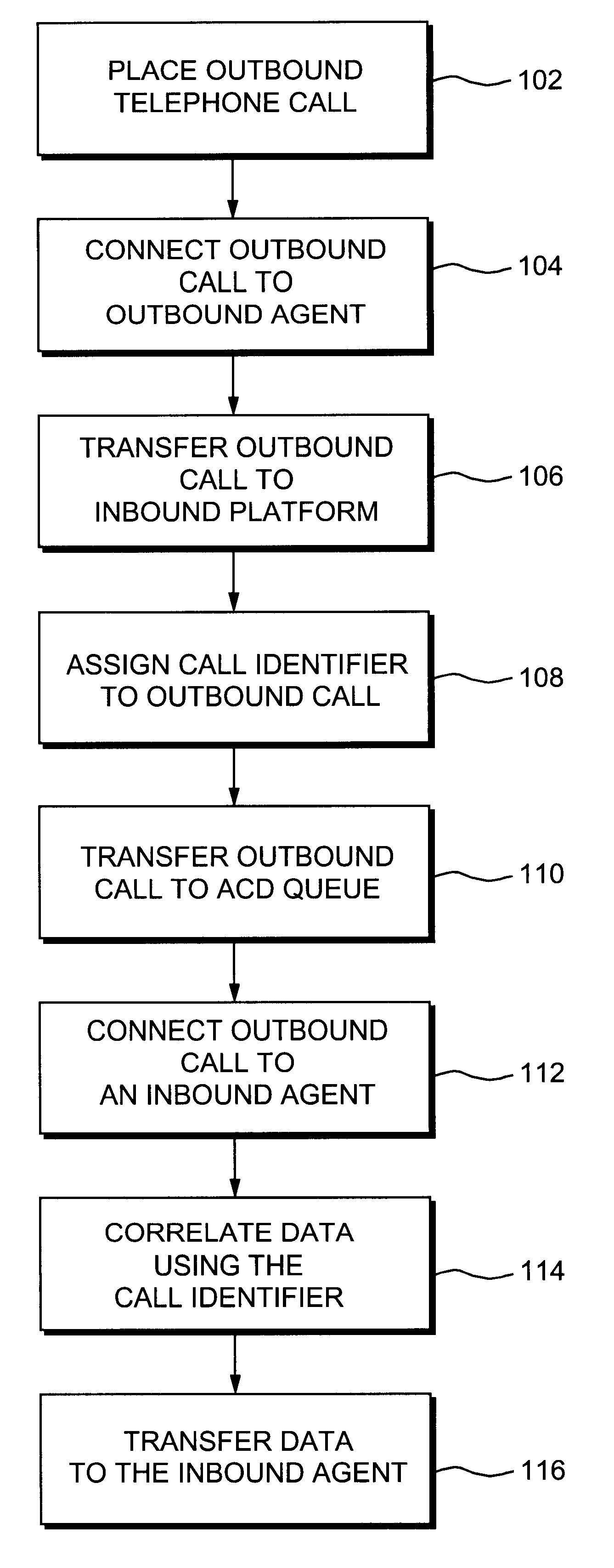

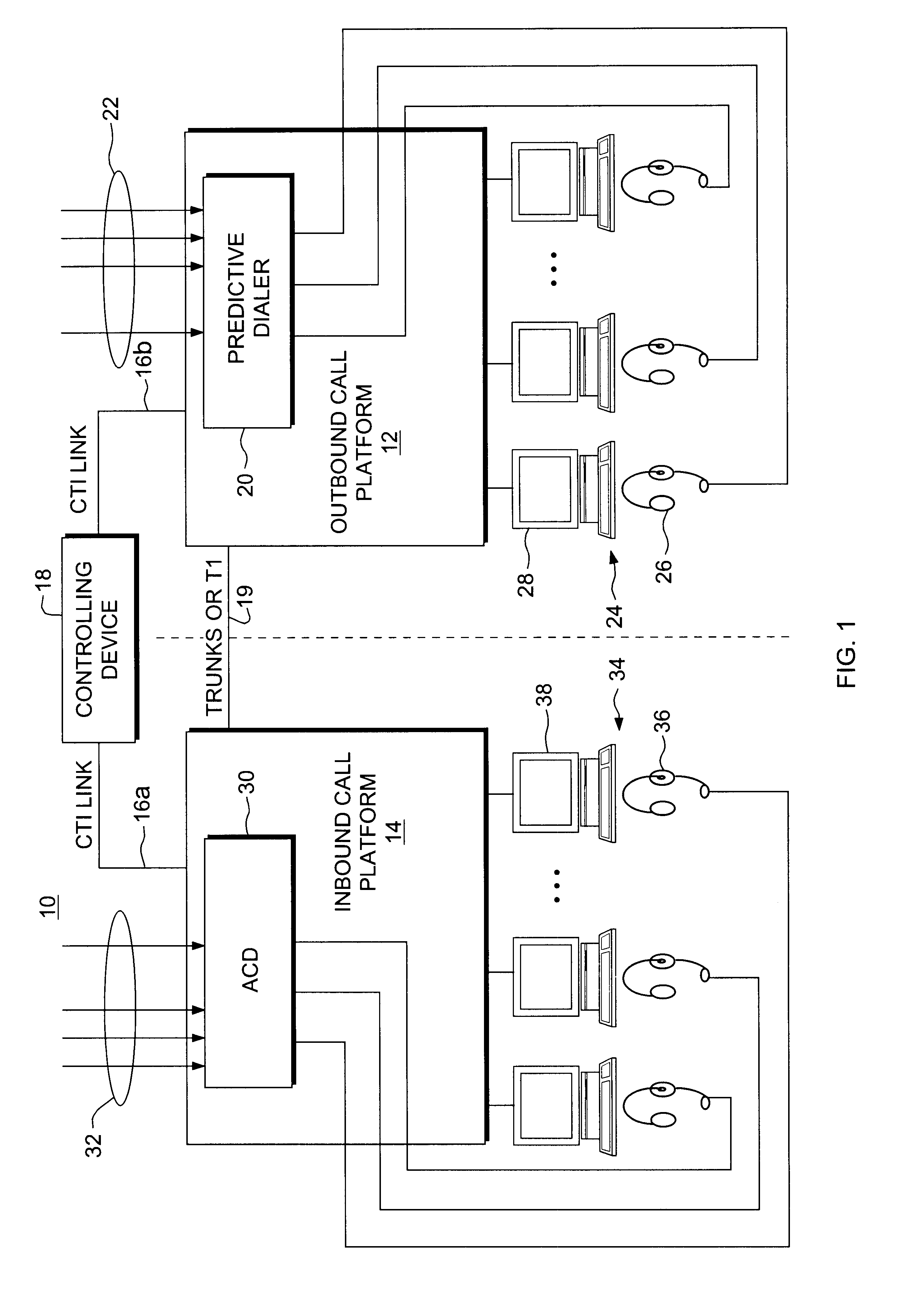

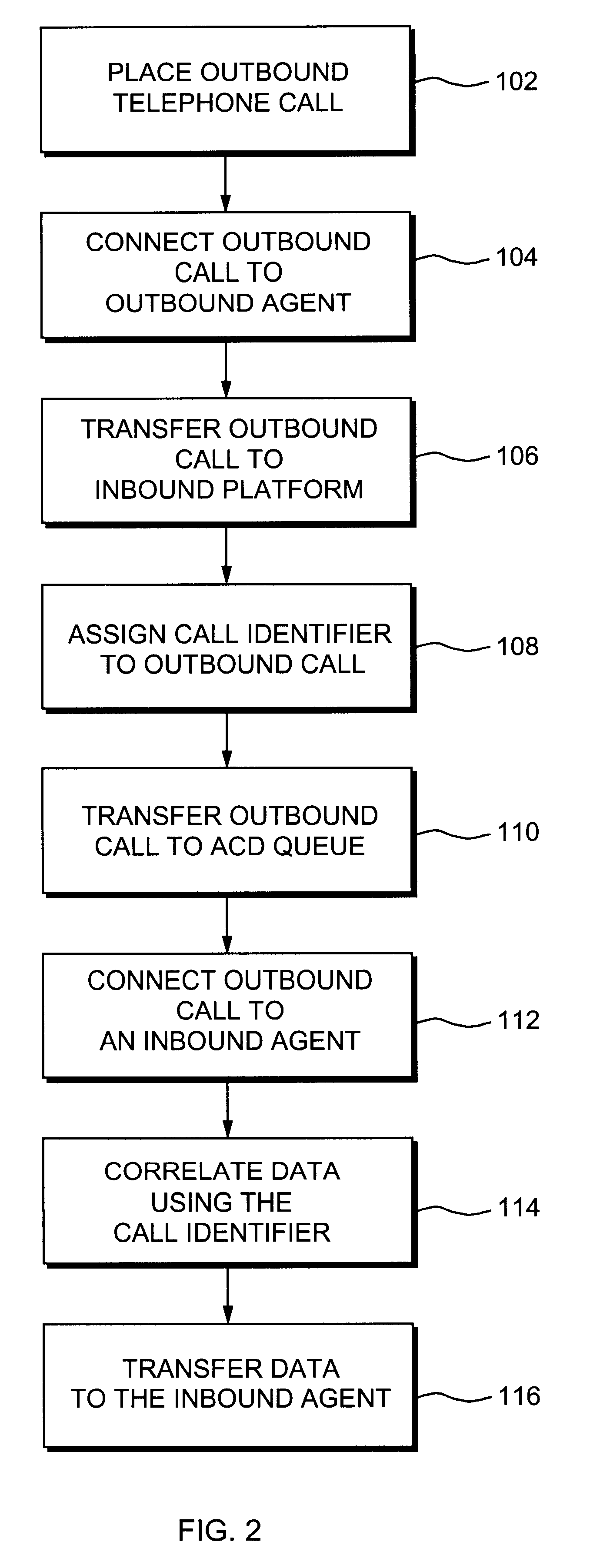

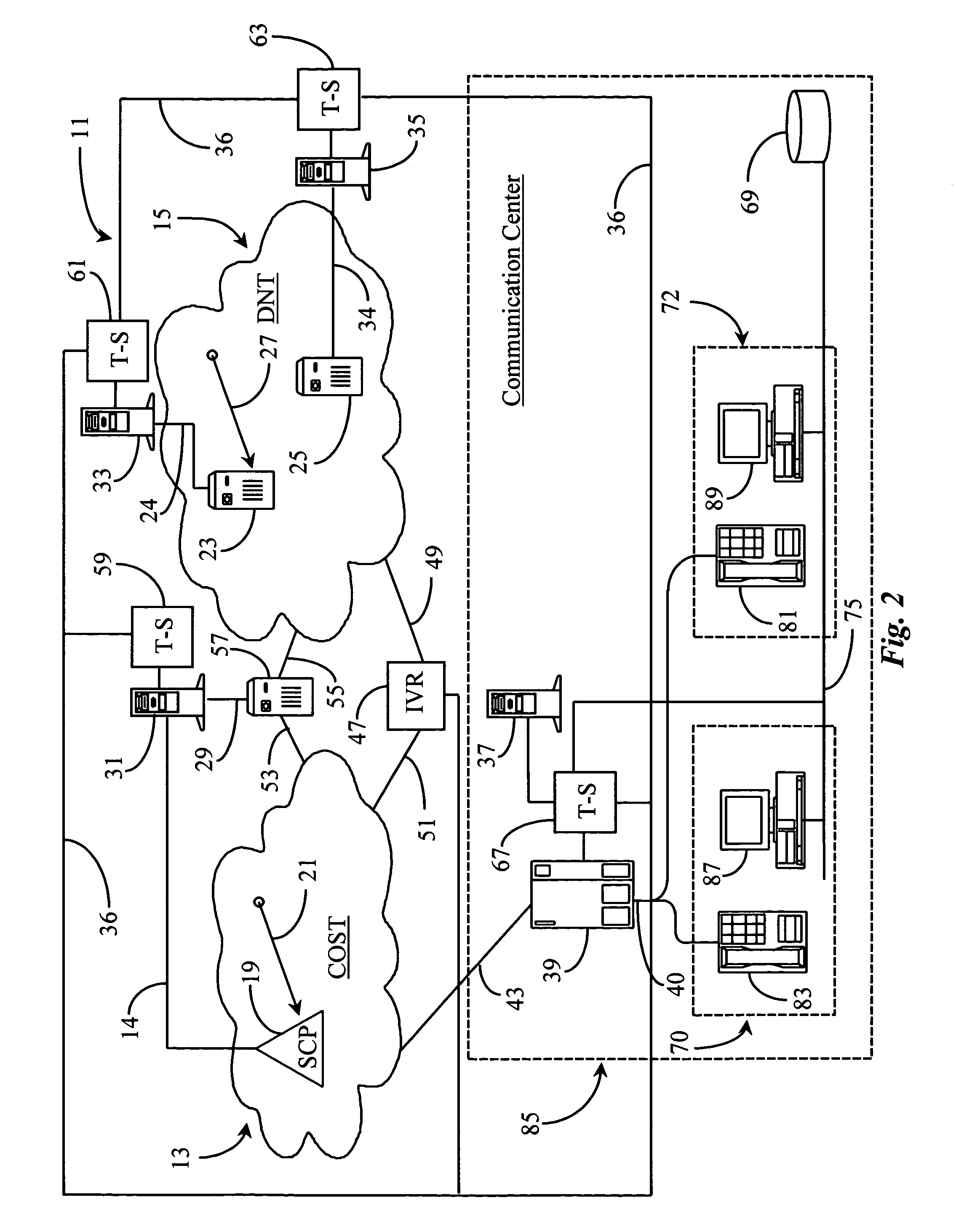

Voice and data transfer from outbound dialing to inbound ACD queue

A system and method for transferring voice and data from an outbound call platform to an inbound call platform. The outbound and inbound call platforms are separate hardware platforms connected to a controlling device using computer telephone integration (CTI) links and connected together using one or more communication paths, such as trunks or T1 lines. If an outbound agent connected to the outbound call platform determines that an outbound call should be handled by an inbound agent connected to the inbound call platform, the outbound agent can request a transfer of that outbound telephone call. The outbound dialer then transfers the voice portion of the outbound telephone call to a predetermined extension on the inbound platform, and the inbound platform assigns a call ID to the transferred outbound call. The transferred outbound call is assigned to the appropriate ACD queue until an inbound agent is available to handle the call. When the voice portion of the call arrives at the headset of the available inbound agent, the call ID is used to correlate the data portion pertaining to the called party with the voice portion, thereby eliminating the need for the inbound agent to request data and manually enter data pertaining to the outbound telephone call.

Owner:ASPECT SOFTWARE INC +1

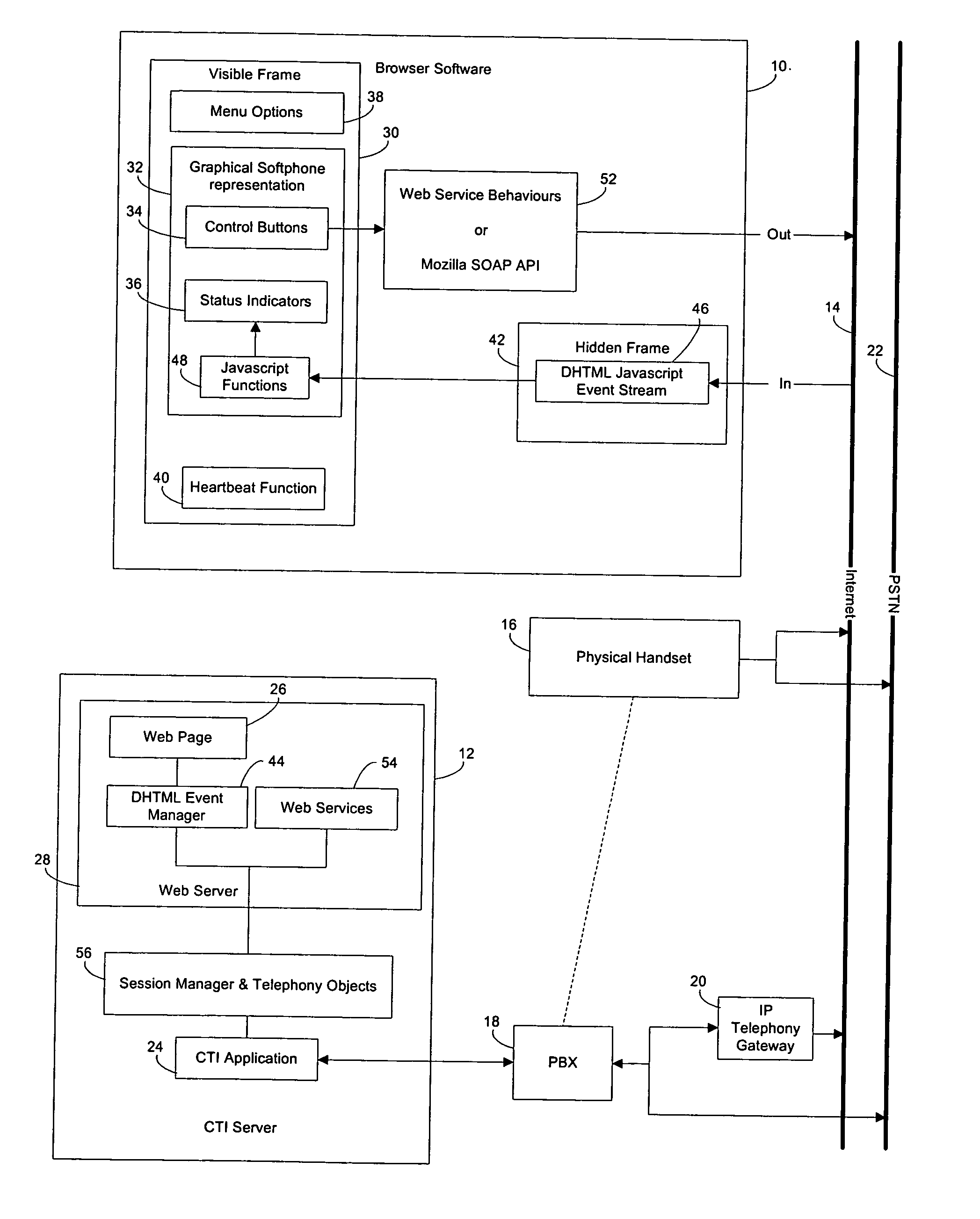

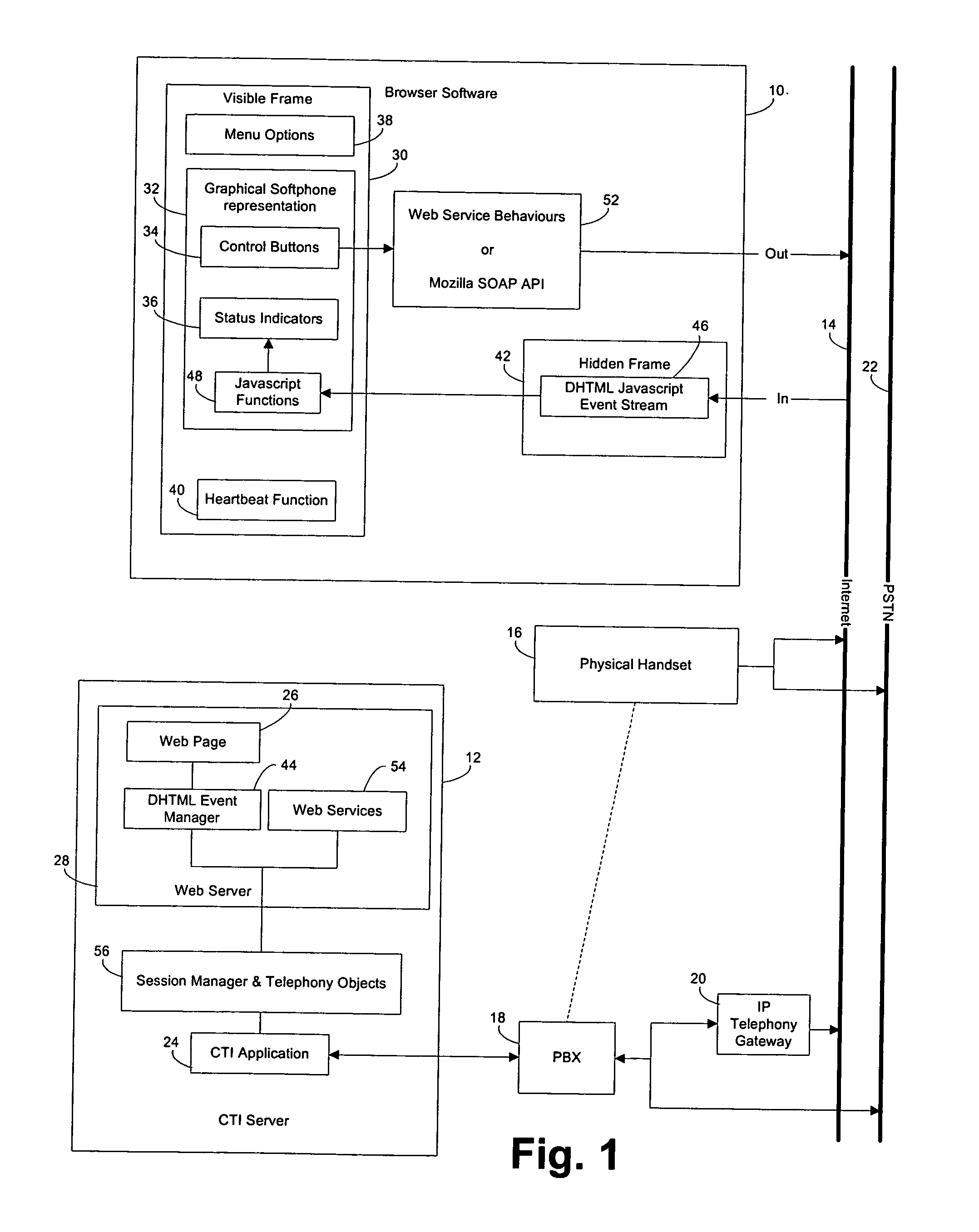

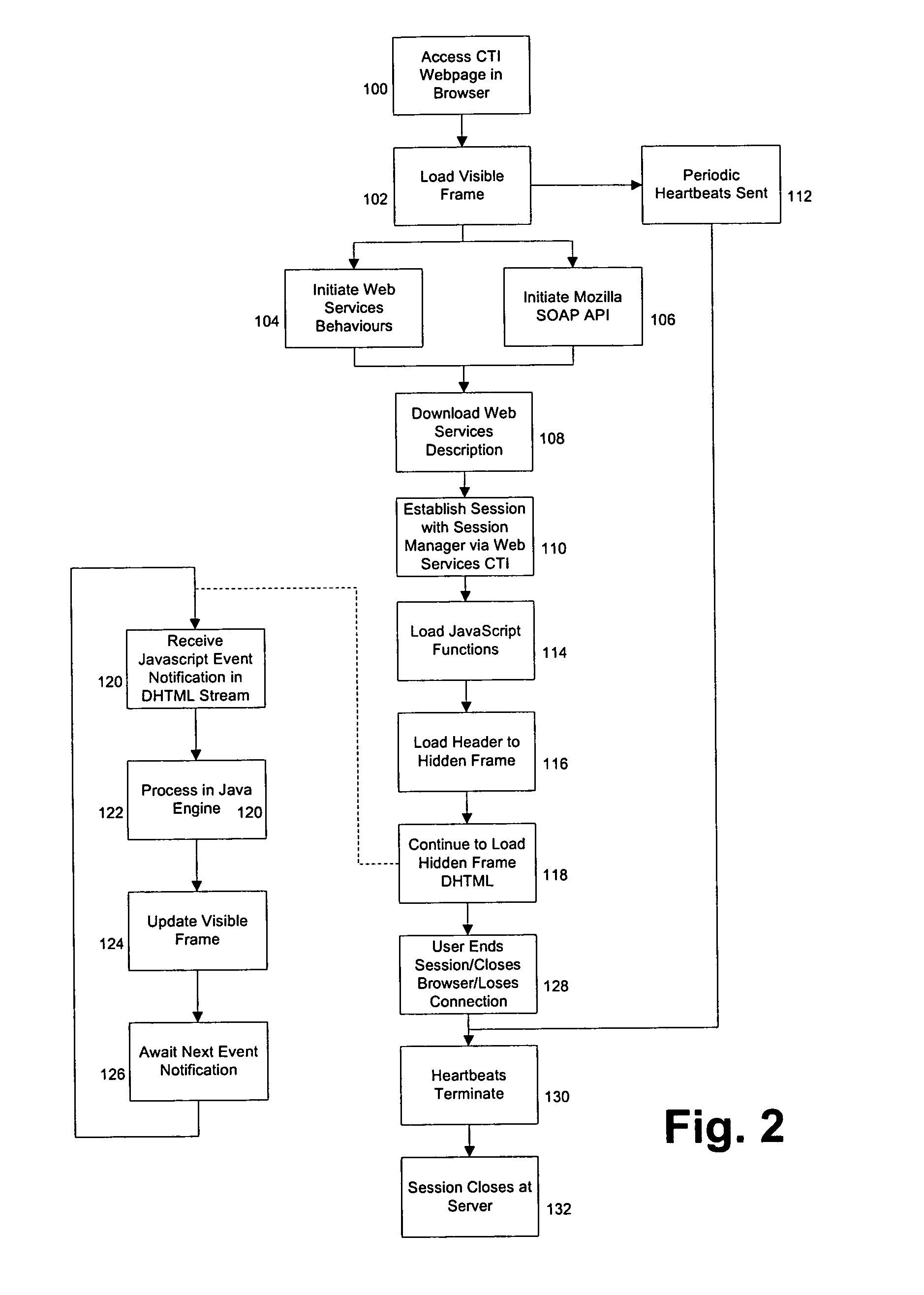

Computer telephone integration over a network

ActiveUS20050138183A1High bandwidthEasy to handleInterconnection arrangementsSpecial service for subscribersWeb serviceNetwork integration

A softphone telephony application is provided within a browser using a visible frame to provide event notifications and allow a user to issue commands and a hidden frame which receive asynchronous event notifications as a dynamic HTML stream. Outgoing control commands are implemented as web service behaviours. In this way, all of the functionality required to control a CTI application on a server and to receive event notifications from the CTI application can be provided using standard browser technology and without requiring the installation of any dedicated software or the provision of non-standard communication channels.

Owner:AVAYA INC

Methods and apparatus for audio data monitoring and evaluation using speech recognition

The present invention relates to audio data monitoring using speech recognition technology. In particular, the present invention uses business rules combined with unrestricted, natural speech recognition to monitor conversations in a customer interaction environment, literally transforming the spoken word to a retrievable data form. Implemented using the VorTecs Integration Platform (VIP), a flexible Computer Telephony Integration base, the present invention enhances quality monitoring by effectively evaluating conversations and initiating actionable events while observing for script adherence, compliance and / or order validation.

Owner:RINGCENTRAL INC

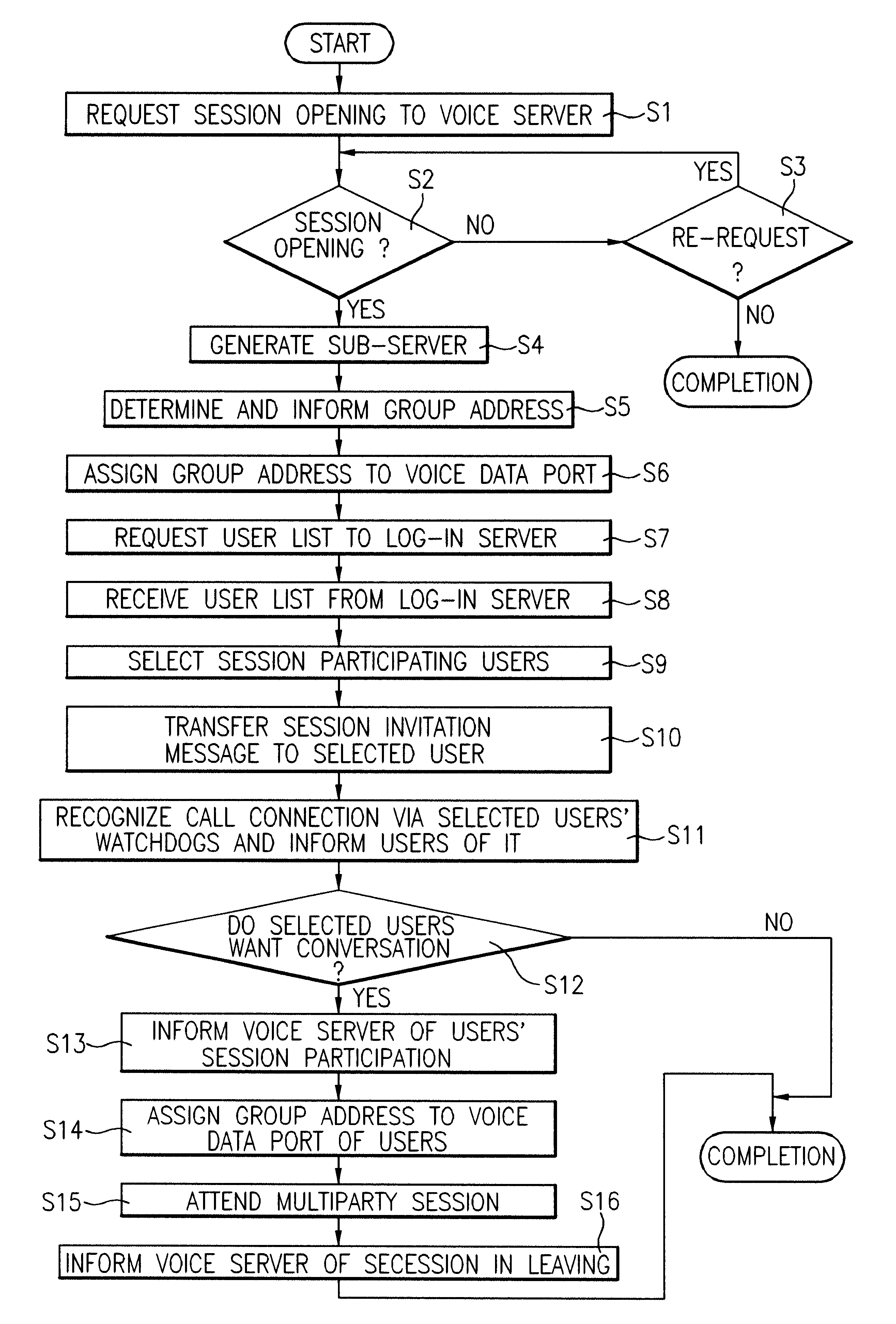

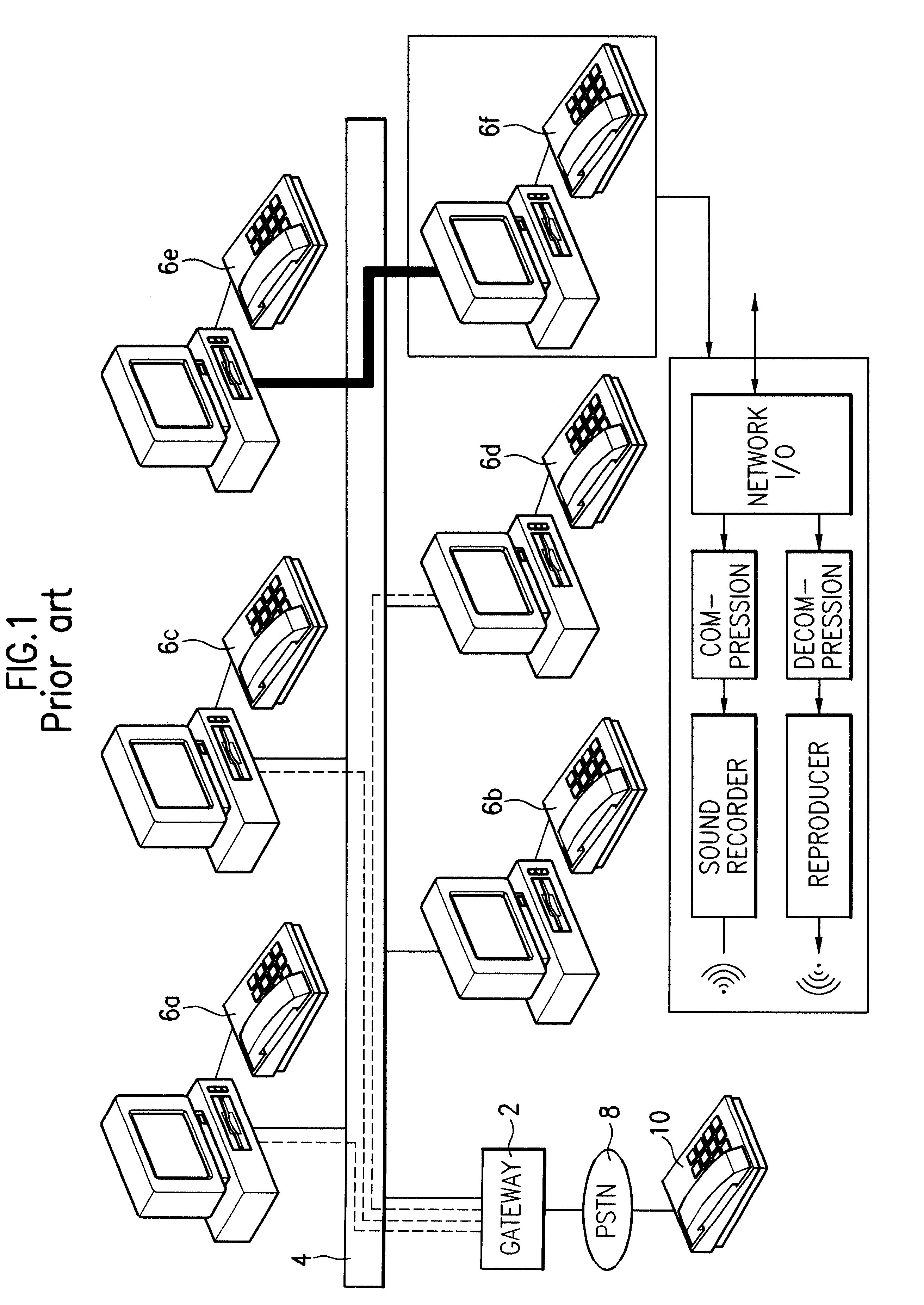

Computer telephony integration system and operation method therein

InactiveUS6522645B1Special service provision for substationSpecial service for subscribersData portMultiparty communication

A computer telephony integration (CTI) system is capable of supporting one-to-one and multiparty communications. An operating method in the CTI system includes a first step for receiving a session opening request from a first user through a voice server thereof; a second step for detecting whether a session is held, in response to the session opening request, and generating, through the voice server thereof, a sub-server for the sake of a new session according to its detecting result; a third step for determining a group address for a multiparty communication in the generated sub-server and informing the first user of the group address; a fourth step for assigning the group address to a voice data port by the first user according to the informed group address; a fifth step for providing a user list when the first user requests the user list so as to select users to be participated in the session and transmitting inviting messages to the users in case that the session participating users are selected; and a sixth step for assigning the group address to the voice data port of a user client system through users who want the telephone conversation, among the users receiving the inviting message through a watchdog of the client system, and making the users participate in the multiparty session.

Owner:LG ELECTRONICS INC

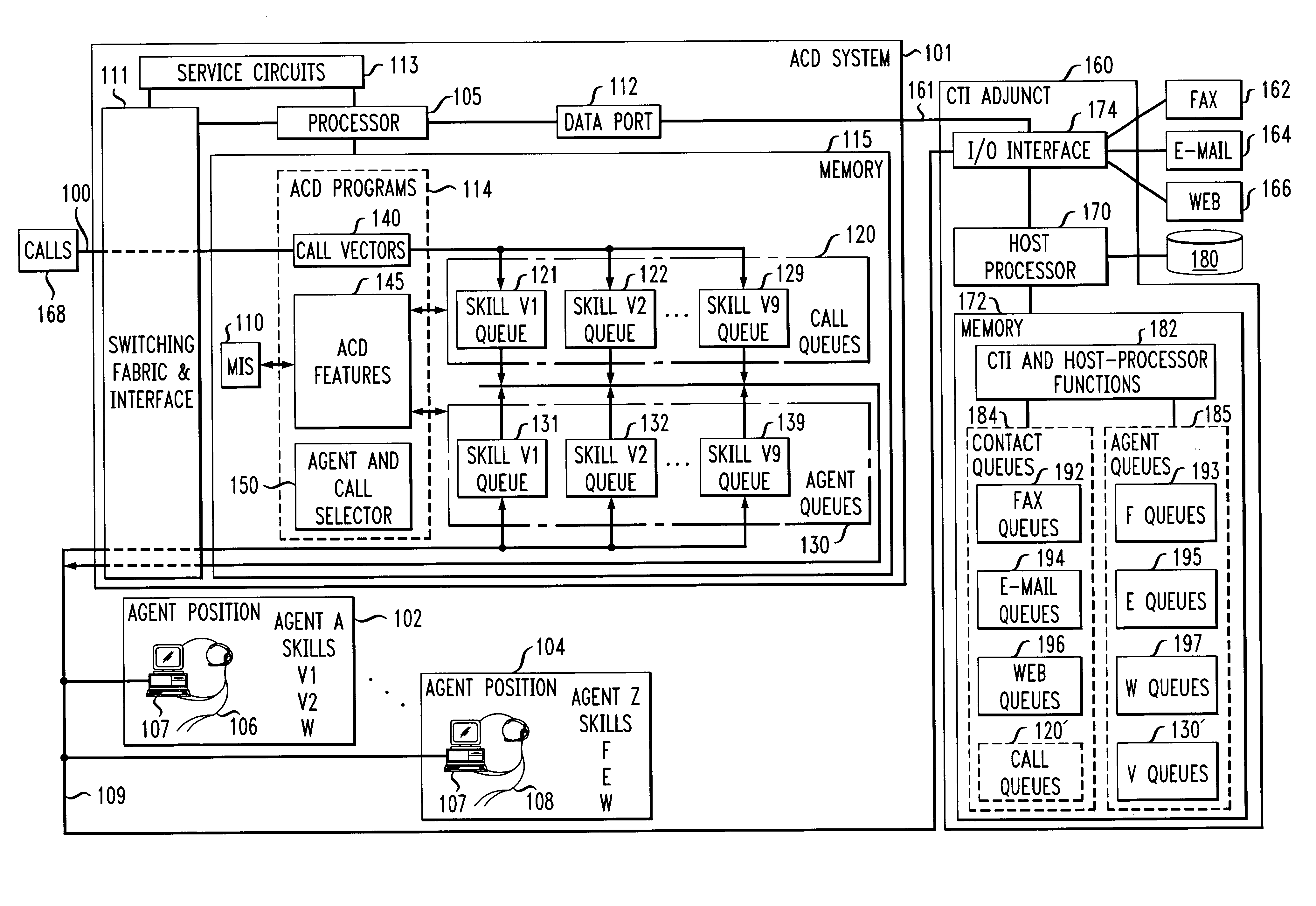

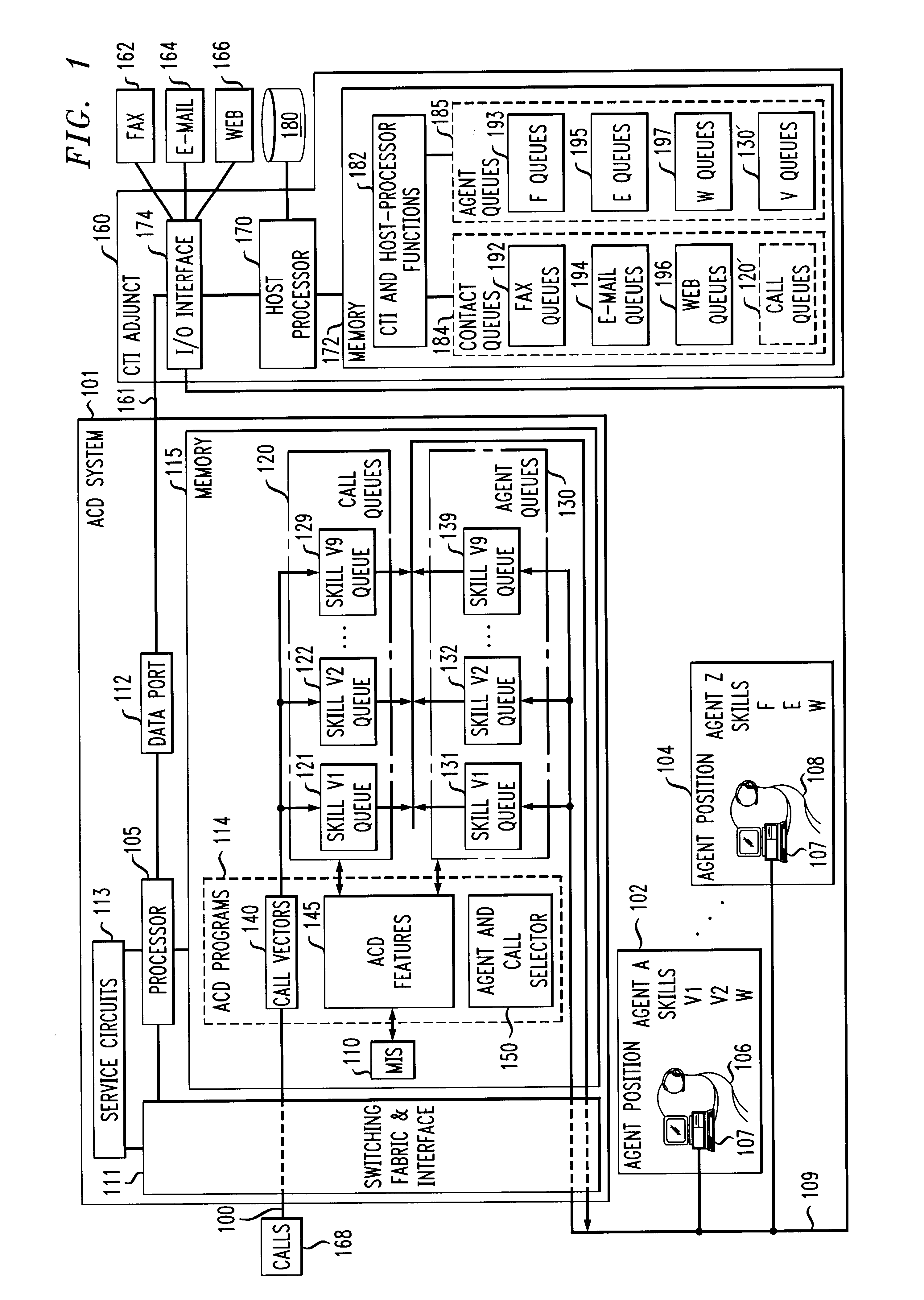

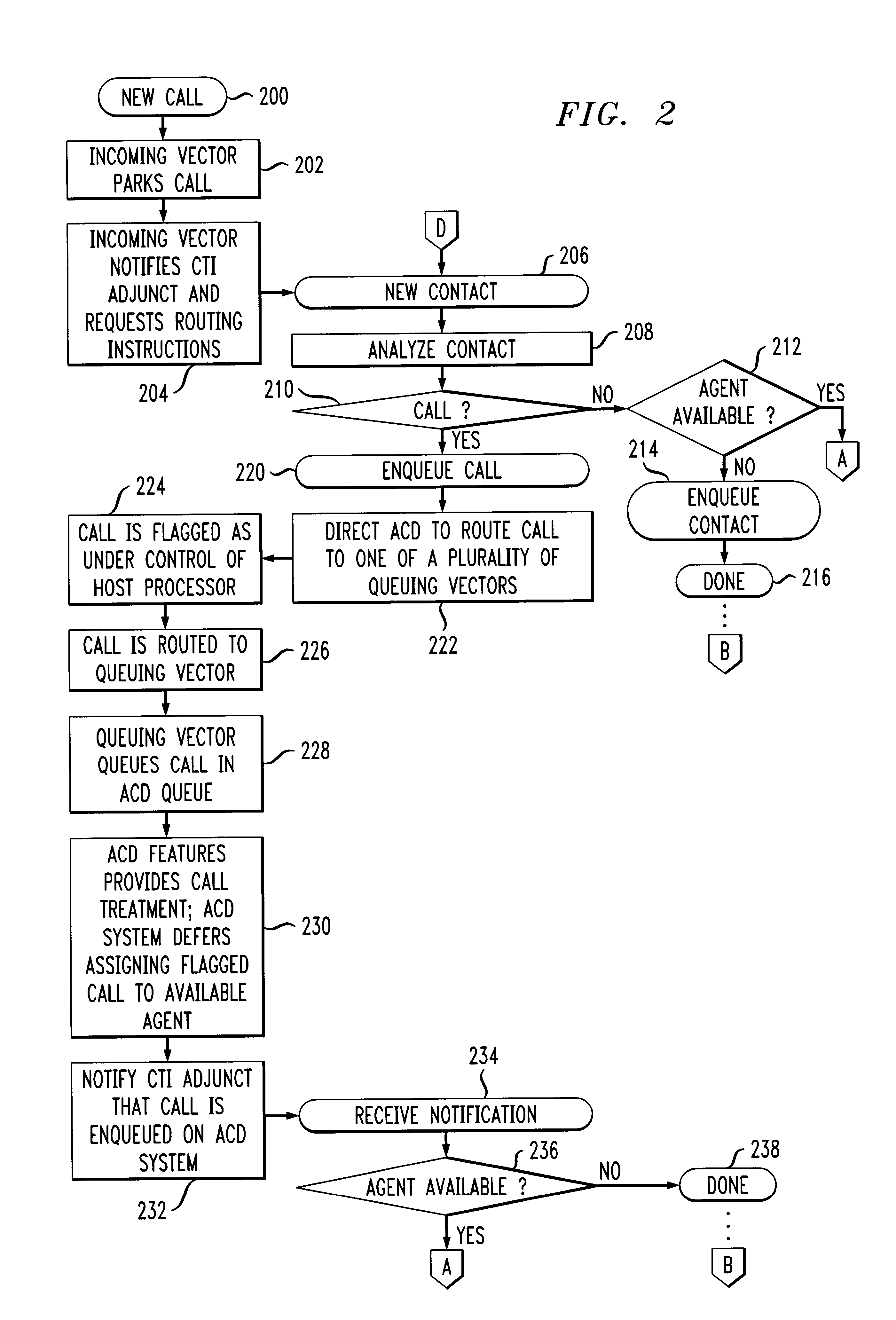

Computer-telephony integration that uses features of an automatic call distribution system

InactiveUS6947543B2Good serviceMinimal disruptionSpecial service for subscribersSupervisory/monitoring/testing arrangementsContact centerHuman–computer interaction

In a computer-telephony integrated (CTI) contact center, a CTI adjunct (160) enqueues contacts in contact queues (184) of the CTI adjunct, but also causes contacts that are calls (168) to be enqueued as ACD calls in ACD call queues (120) of an ACD system (101), whereby the ACD system and its management information system (MIS 110) provide ACD features to the calls. Similarly, the CTI adjunct enqueues agents in agent queues (185) of the CTI adjunct, but also causes agents (102-104) that have call-handling skills to log into and to be enqueued as ACD agents in ACD agent queues (130) of the ACD system, whereby the ACD system and its MIS provide ACD features to the agents.

Owner:AVAYA INC

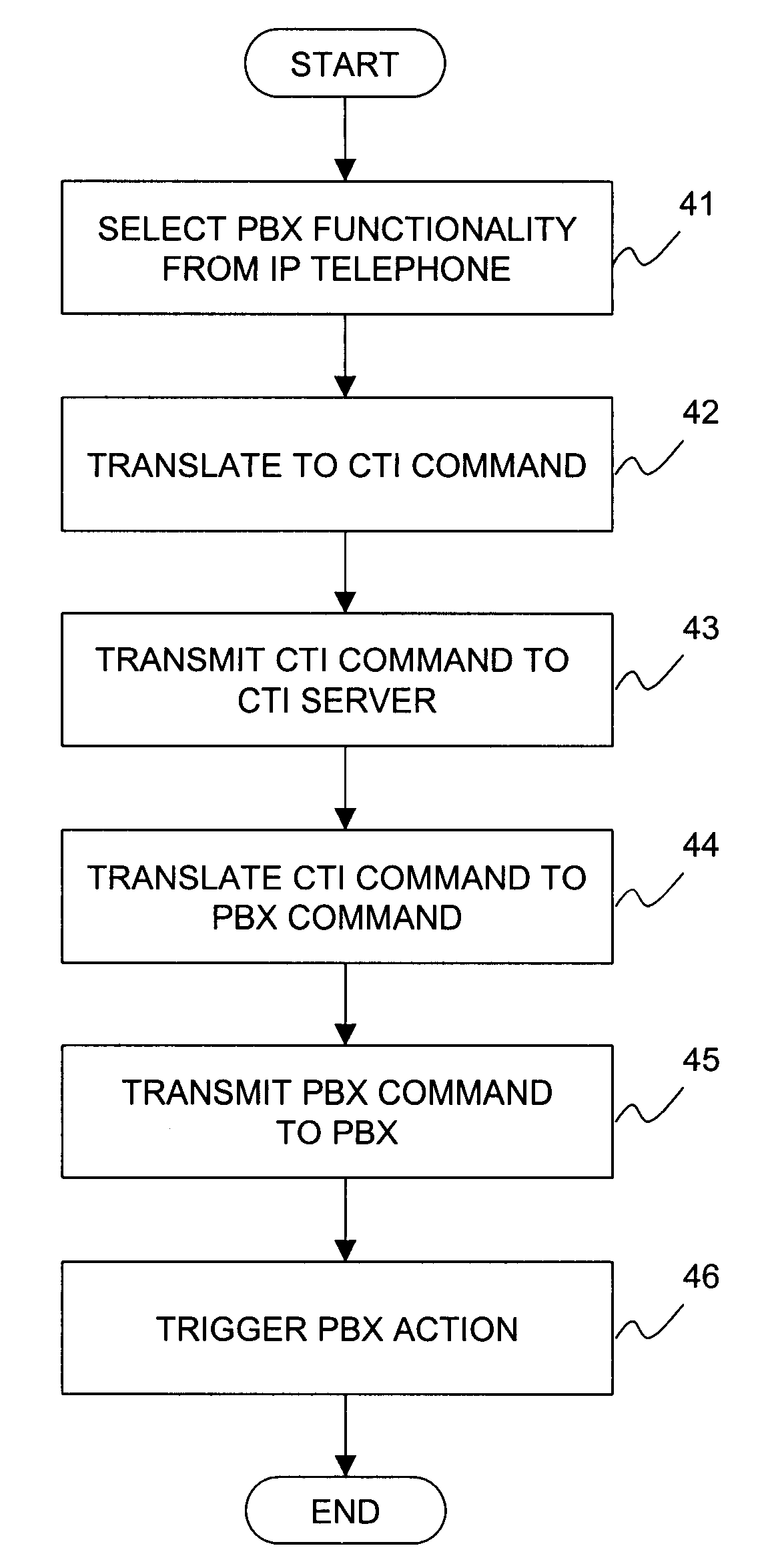

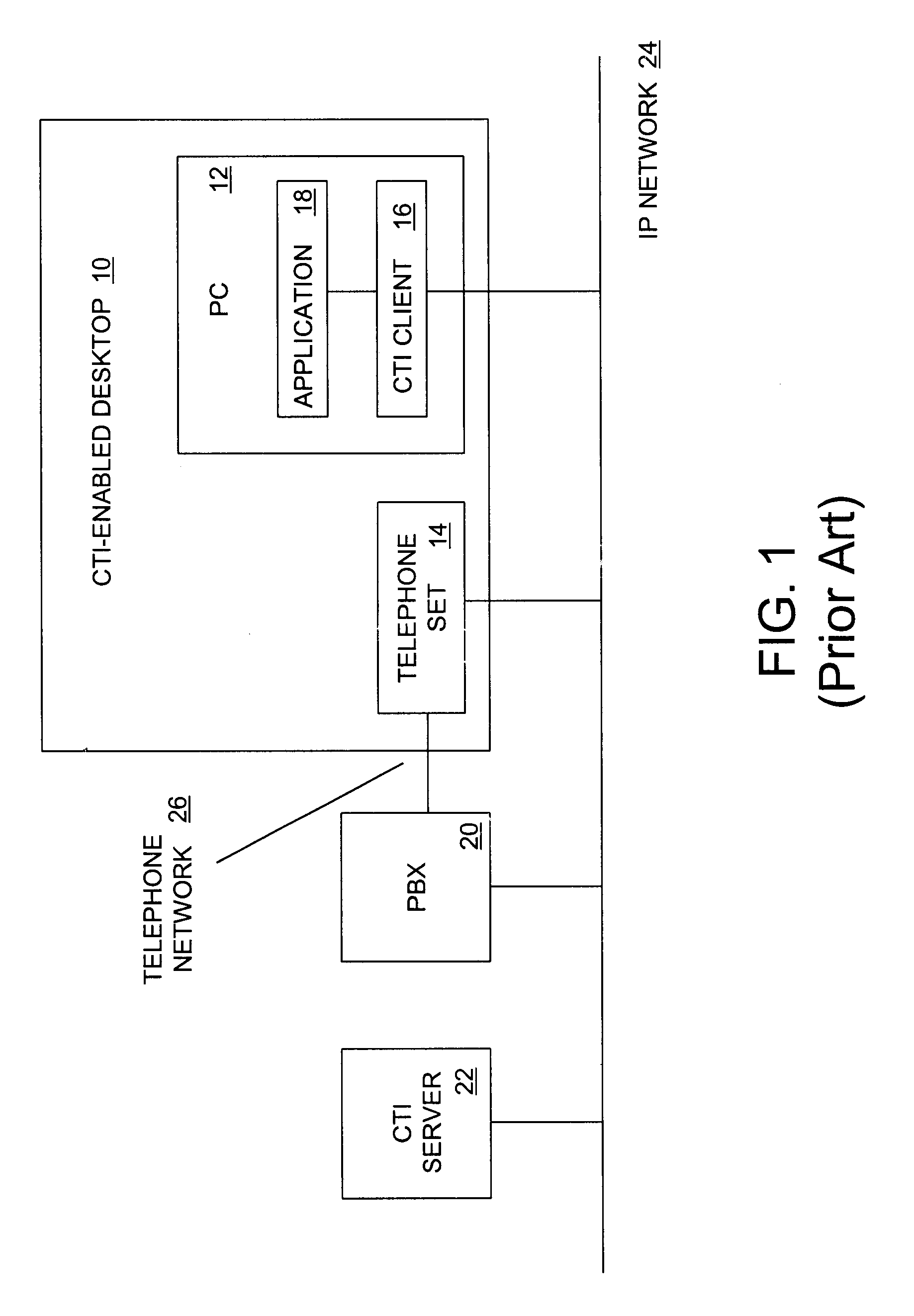

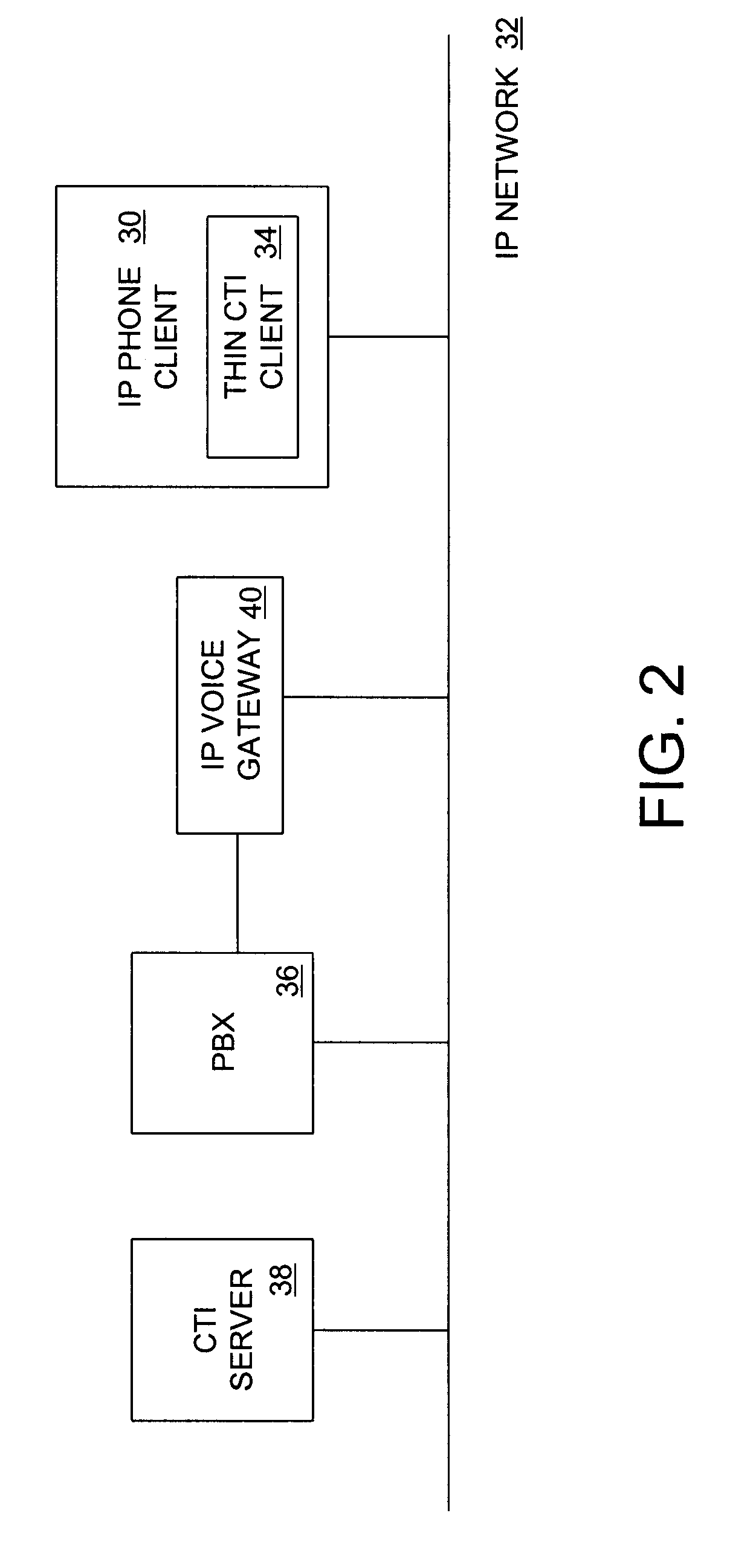

Enhanced IP phone operation

InactiveUS6909778B2Simplifies migration pathMultiplex system selection arrangementsSpecial service provision for substationSignaling protocolClient-side

An enhanced IP telephone taking advantage of the many call-related functions provided by existing PBX systems. The enhanced IP telephone includes a thin computer telephony integration (CTI) client transmitting to a CTI server a command associated with a particular call-related function provided by a PBX unit. The CTI server translates the command to a PBX command, and transmits the PBX command to the PBX unit for providing the particular call-related function to the enhanced IP telephone. Instead of the thin CTI client, the enhanced IP telephone may include an enhanced IP signaling protocol stack for accessing the PBX functionality using its signaling protocol. A CTI translator translates the enhanced signaling command to a CTI command for transmitting to the CTI server.

Owner:ALCATEL LUCENT SAS

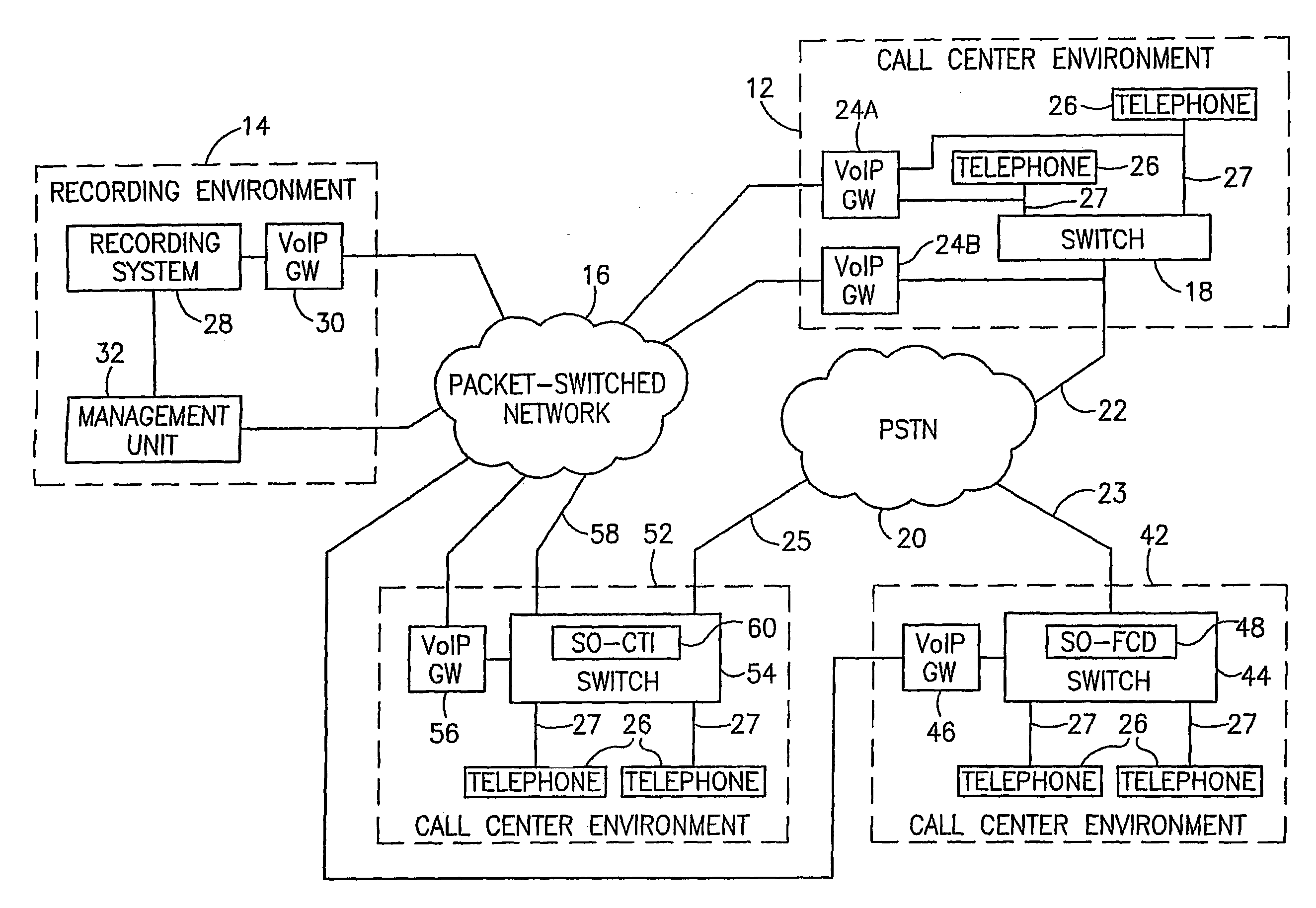

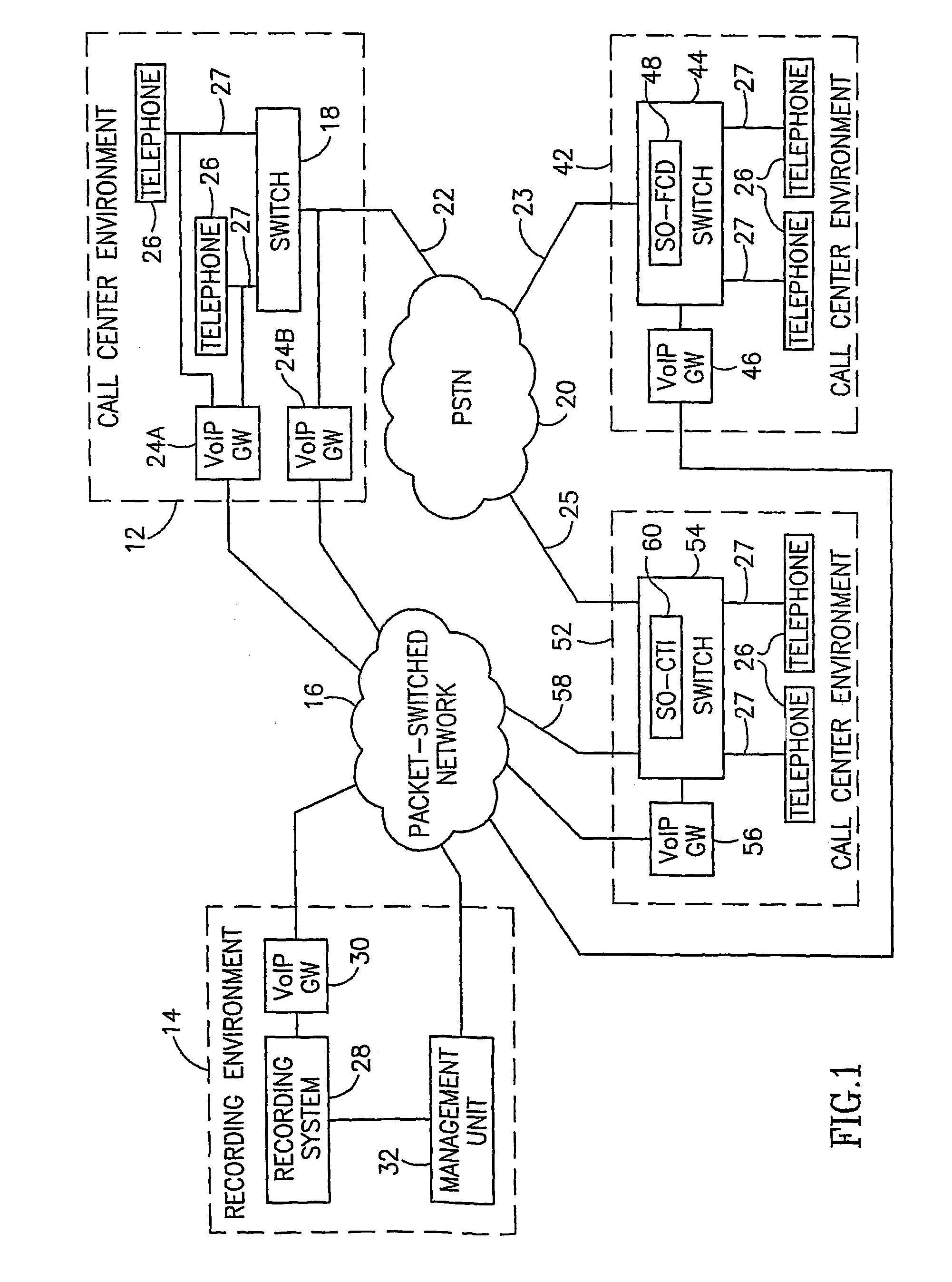

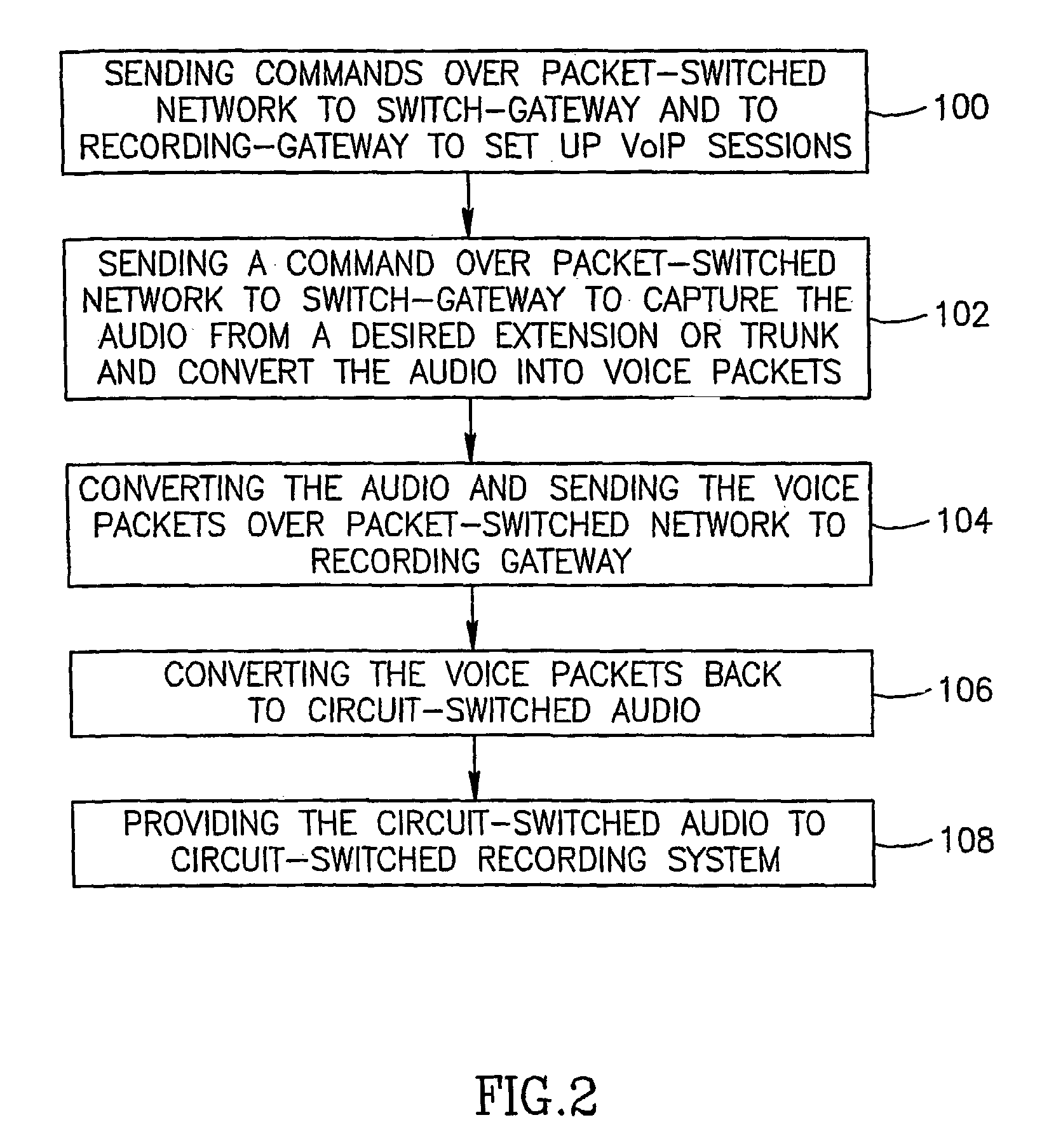

Method and system for monitoring and recording voice from circuit-switched via a packet-switched network

ActiveUS7333445B2Interconnection arrangementsSpecial service for subscribersVoIP recordingExchange network

Some embodiments of the present invention are directed to a method and system for monitoring and recording voice from circuit-switched switches via a packet-switched network. A circuit-switched or VoIP recording system may record and / or live-monitor telephone calls by trunk and / or extension tapping over a packet-switched network Alternatively, a circuit-switched or VoIP recording system may record and / or live-monitor telephone calls over a packet-switched network by activating the service observation feature of the circuit-switched switch either by feature code dialing or a computer telephony integration (CTI) link command.

Owner:NICE LTD

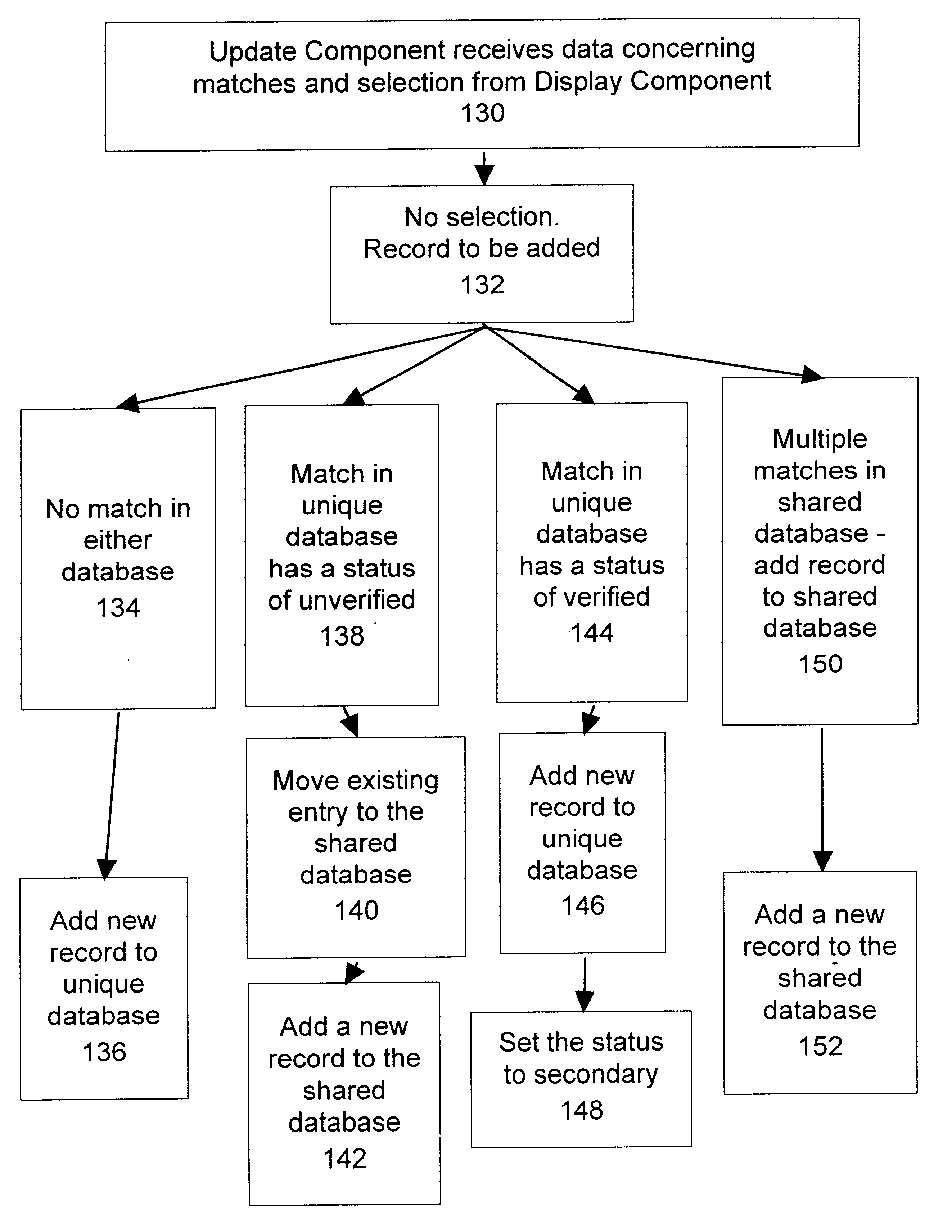

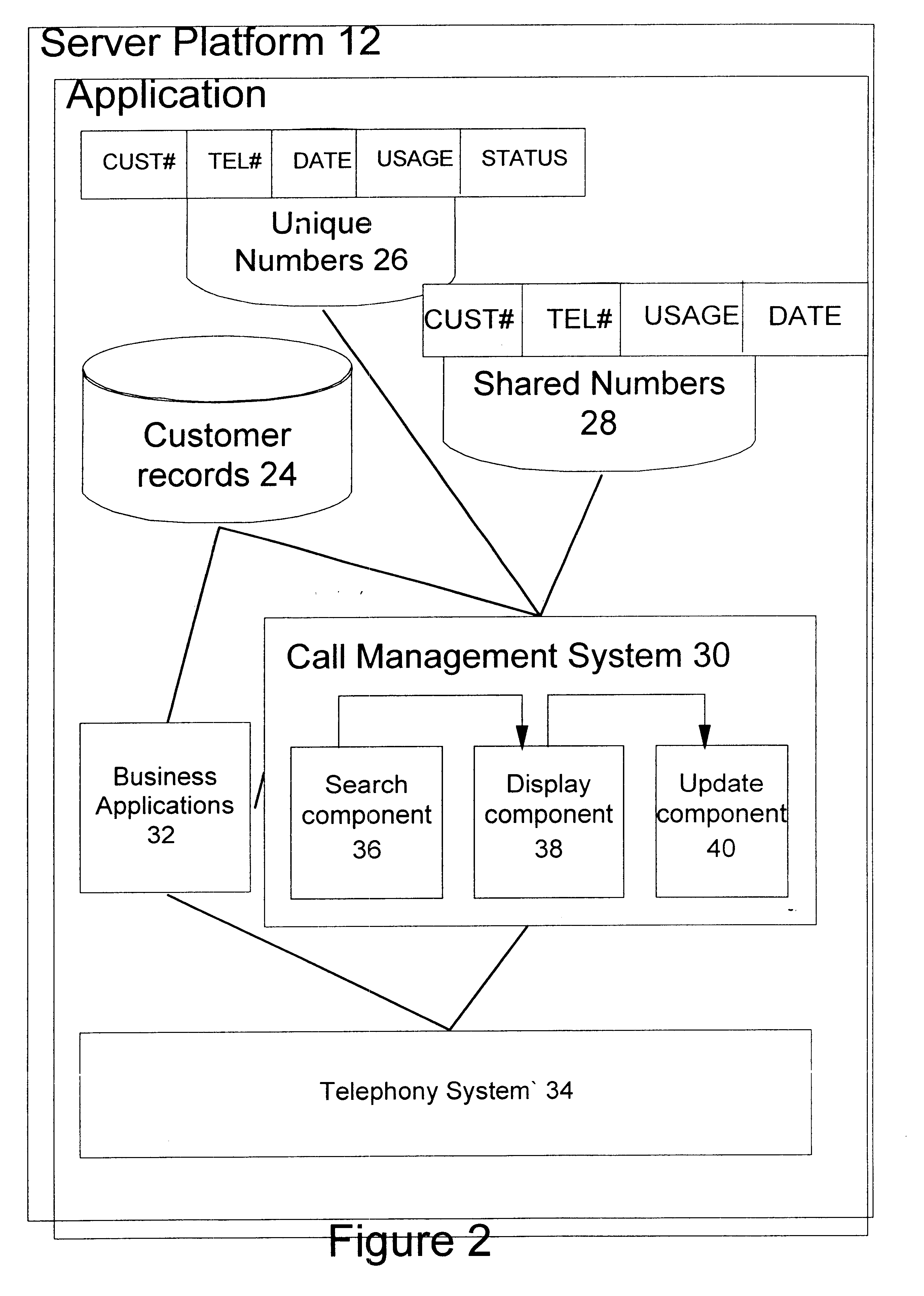

Maintaining a customer database in a CTI system

InactiveUS6614895B1Save on agentResource optimizationSpecial service for subscribersCalling susbscriber number recording/indicationState dependentDatabase

This invention relates to maintaining a customer database in a computer telephony integrated (CTI) database. In particular it relates to populating and maintaining a customer database in a computer telephony system with shared and unique telephone numbers. There is described a method, apparatus and a computer program product relating to the processing records in a telephony database. The telephony system receives an ANI number along with an incoming call and uses that number to identify records, if any, in the customer database having telephone numbers that match the ANI number. A new record is created in the database if no record from the identified records corresponds to the incoming telephone call and the new record includes a telephone number field containing the ANI number. If one or more records were identified in the database the telephone number in the new record is associated with a shared status.

Owner:IBM CORP

Integrated travel industry system

A system and method providing a centralized network for facilitating travel reservations and / or services. The system comprises a network with hub sites that provide a centralized connection for Global Distribution Systems / Computer Reservation Systems, travel vendors, and travel office point of service terminals. The travel office point of service terminals provide a plurality of modules for various travel related applications such as a low fare search module, a computer telephony integration module, a super passenger name record database, a customer database, a trip planning module, a customer relationship management module, a workflow module, and an integrated e-mail booking system.

Owner:LIBERTY PEAK VENTURES LLC

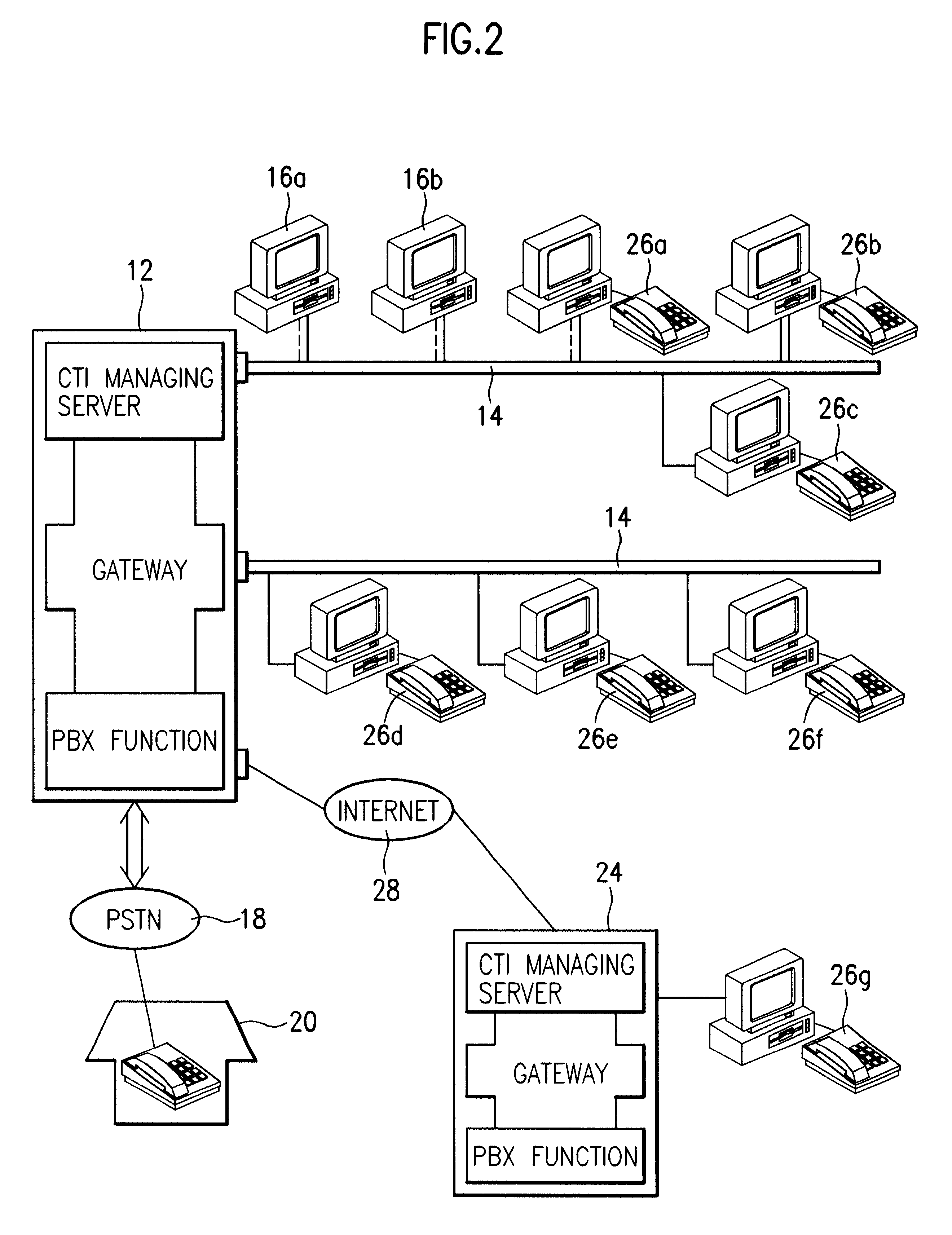

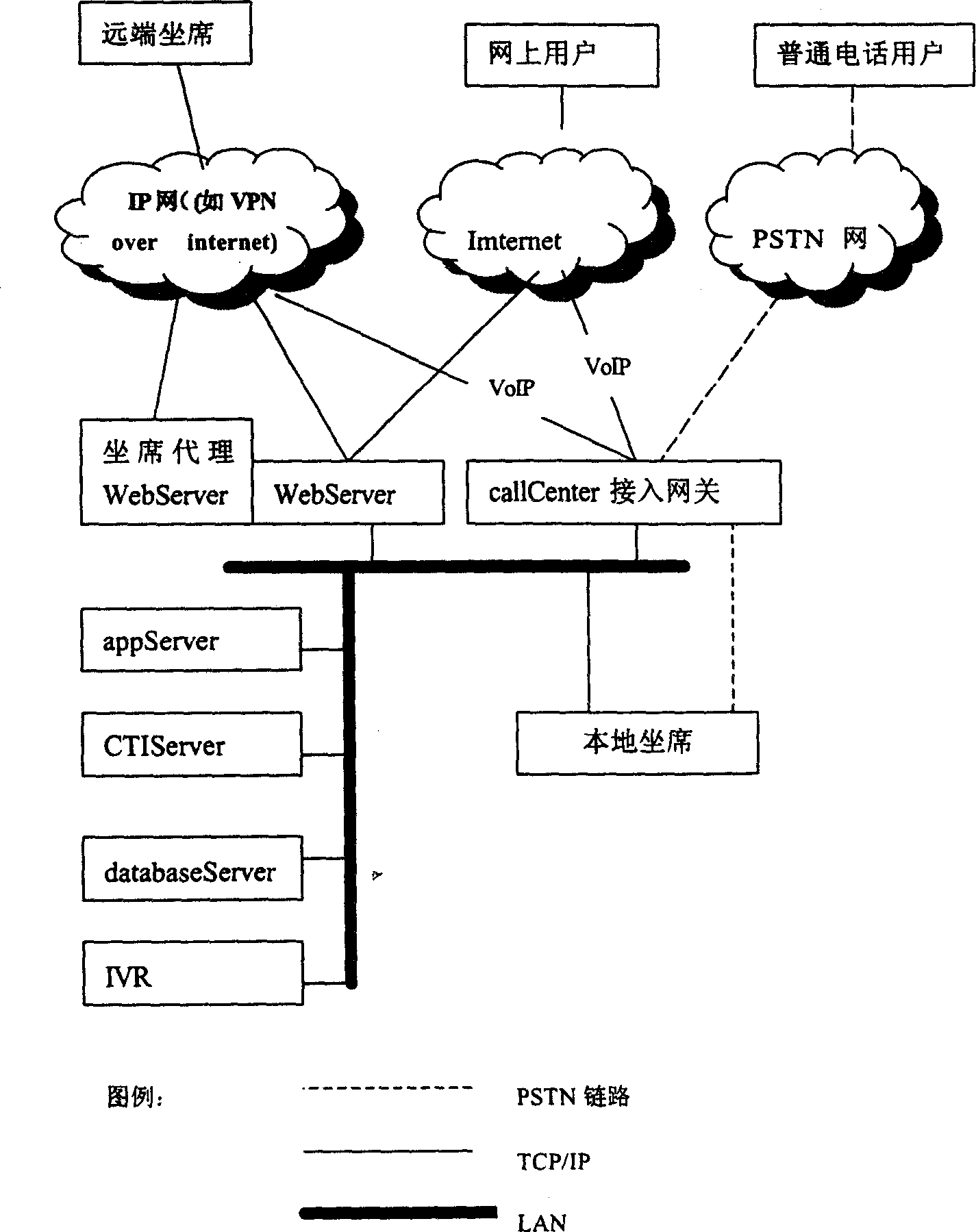

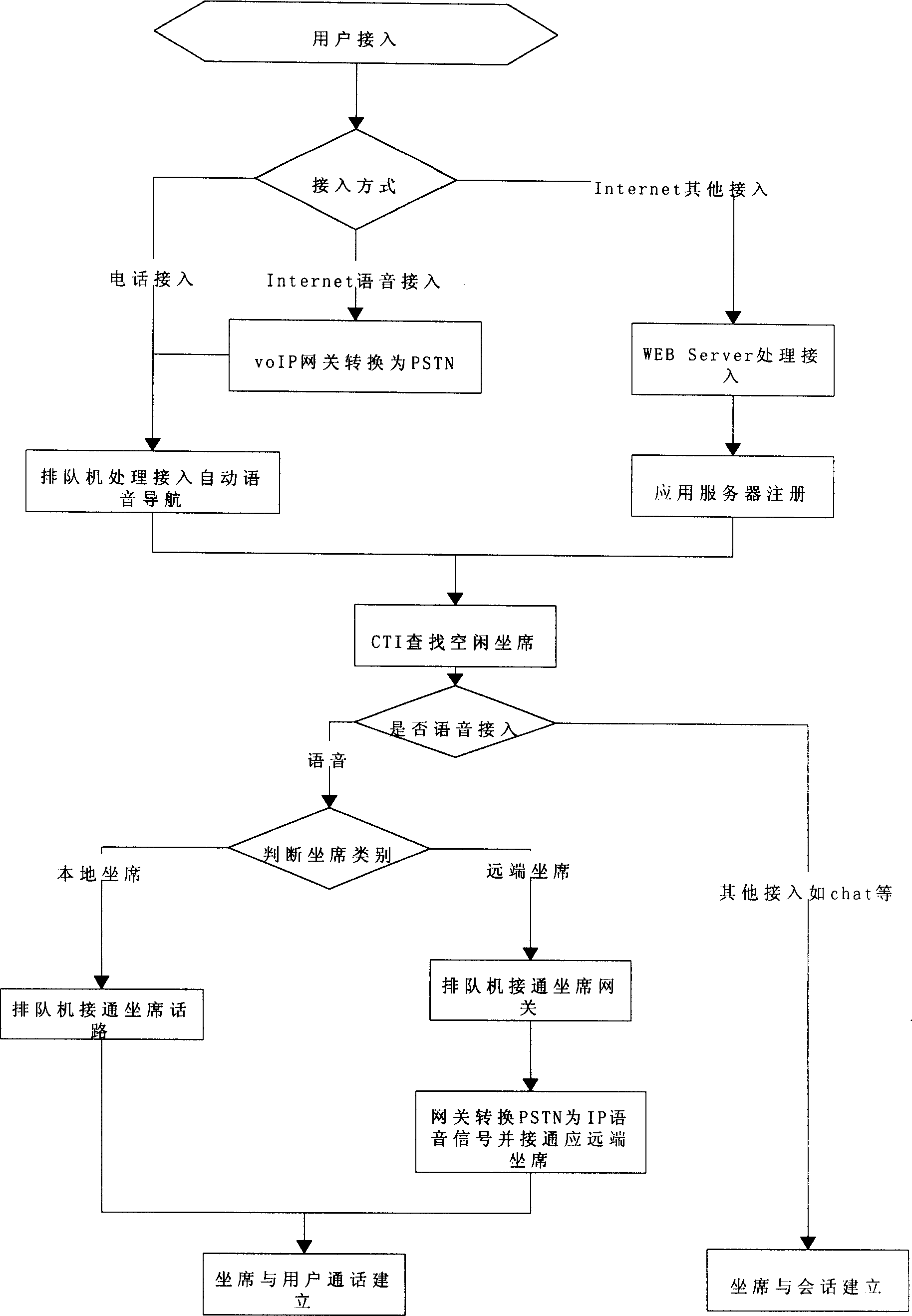

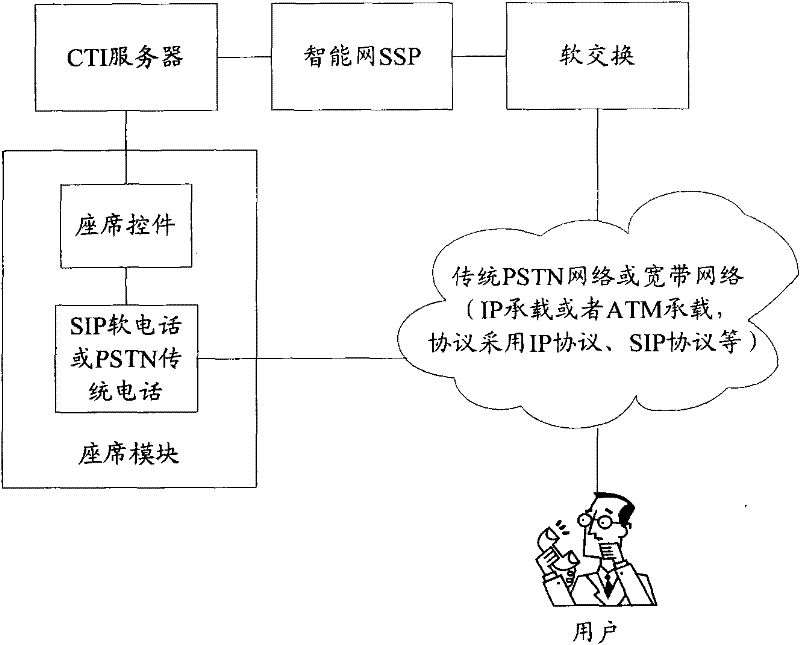

Calling centre compatible with public switched telenet and interconnected network and its access method

InactiveCN1428982ARealize a unified service modelAchieve transparencyNetwork connectionsSelection arrangementsInteractive voice response systemNetwork service

The present invention discloses a calling centre compatible with public switched telecommunication network and interconnected network and its access method. It includes interactive voice response system (IVR), CTI server, web server, APP server, local position, far-end position and database server and call centre access gateway. Said invented calling centre can be compatible with different access modes, and can implement unified service mode so as to raise the system property of calling centre.

Owner:ZTE CORP

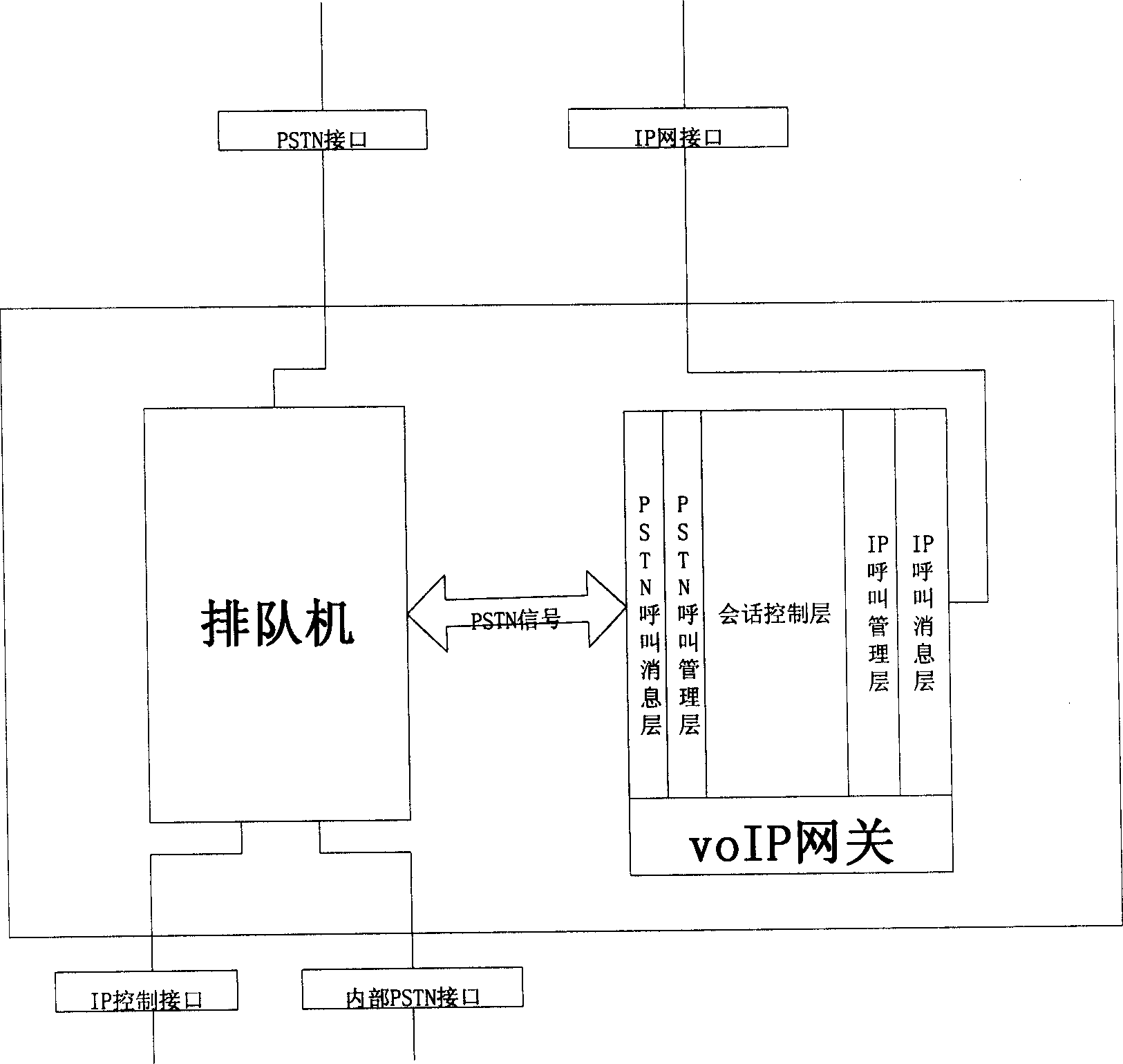

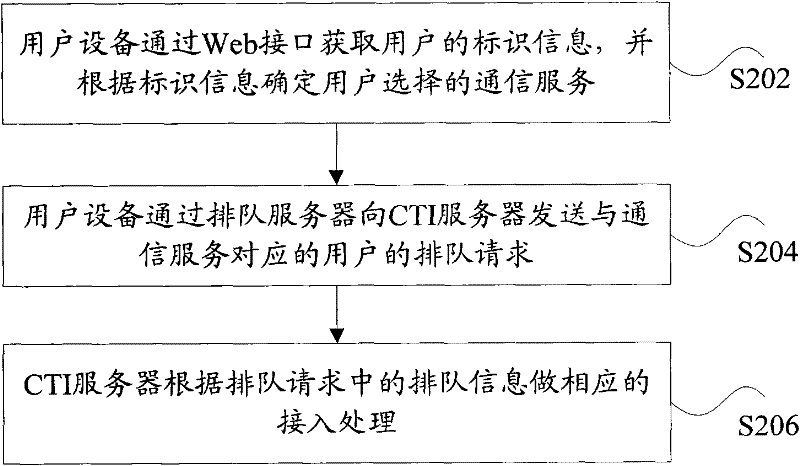

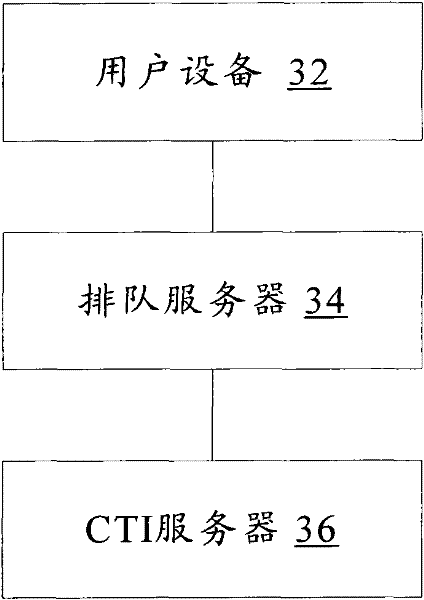

Call center system and its access method

InactiveCN102281364AImprove experienceSolve efficiency problemsInterconnection arrangementsSpecial service for subscribersAccess methodUsability

The present invention discloses a call center system and an access method thereof. The method includes: a UE acquiring identification information of a user through a web interface, and determining a communication service selected by the user according to the identification information; the UE sending a queuing request of the user corresponding to the communication service to a Computer Telephony Integration (CTI) server through a queuing server; and the CTI server performing corresponding access processing according to the queuing information of the queuing request. The present invention improves the performance and usability of the system, and the user experience.

Owner:钱小九

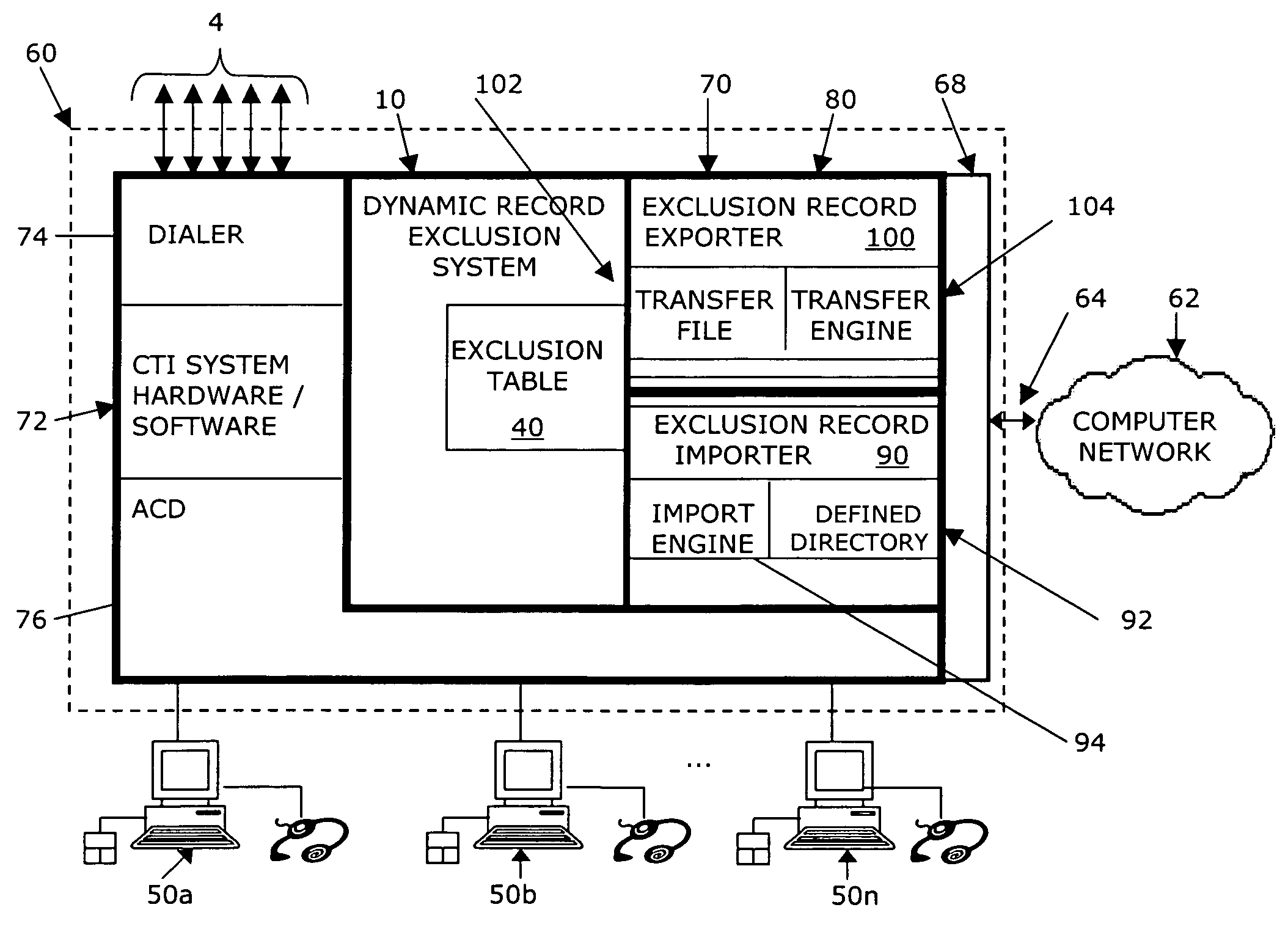

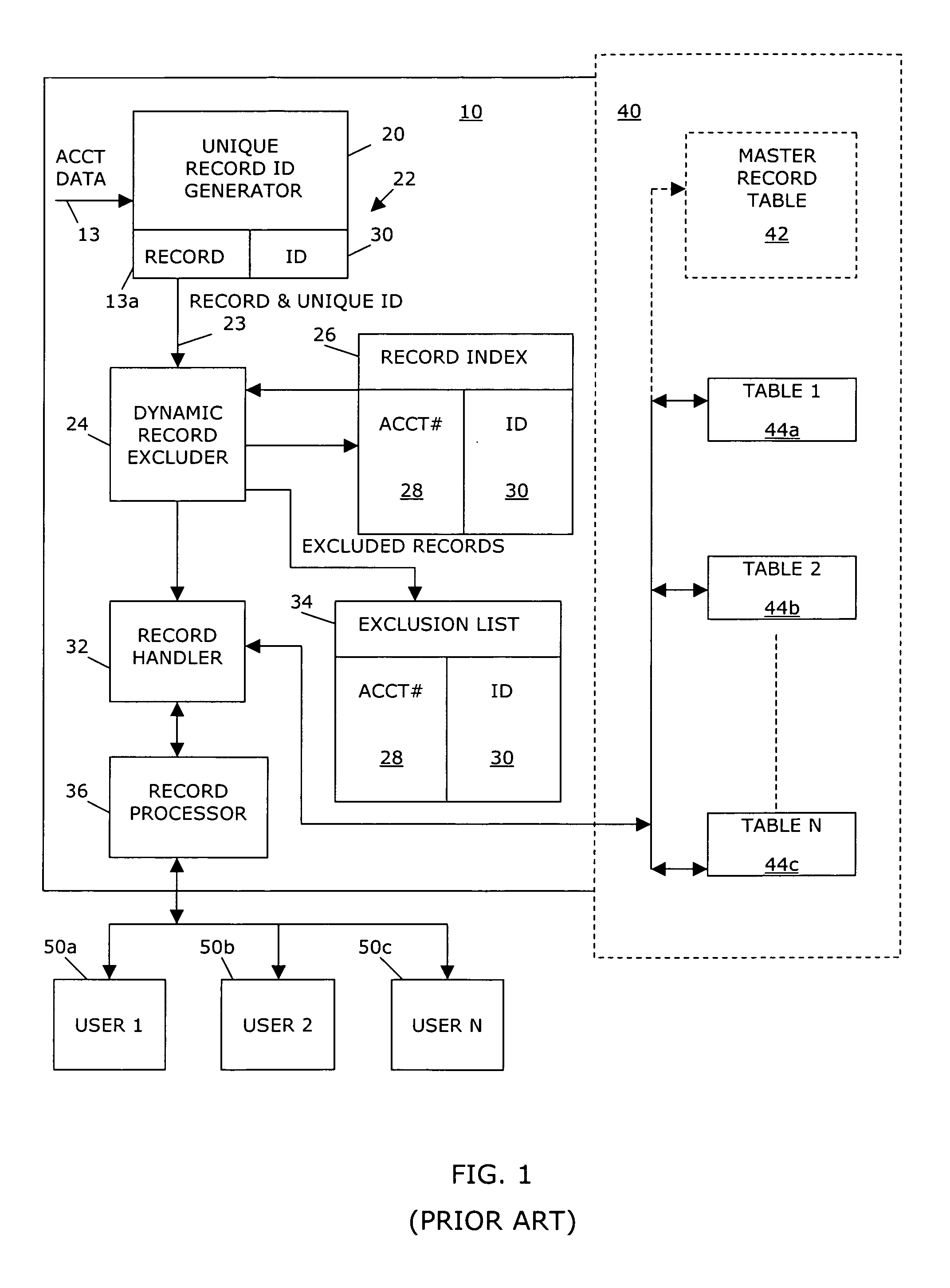

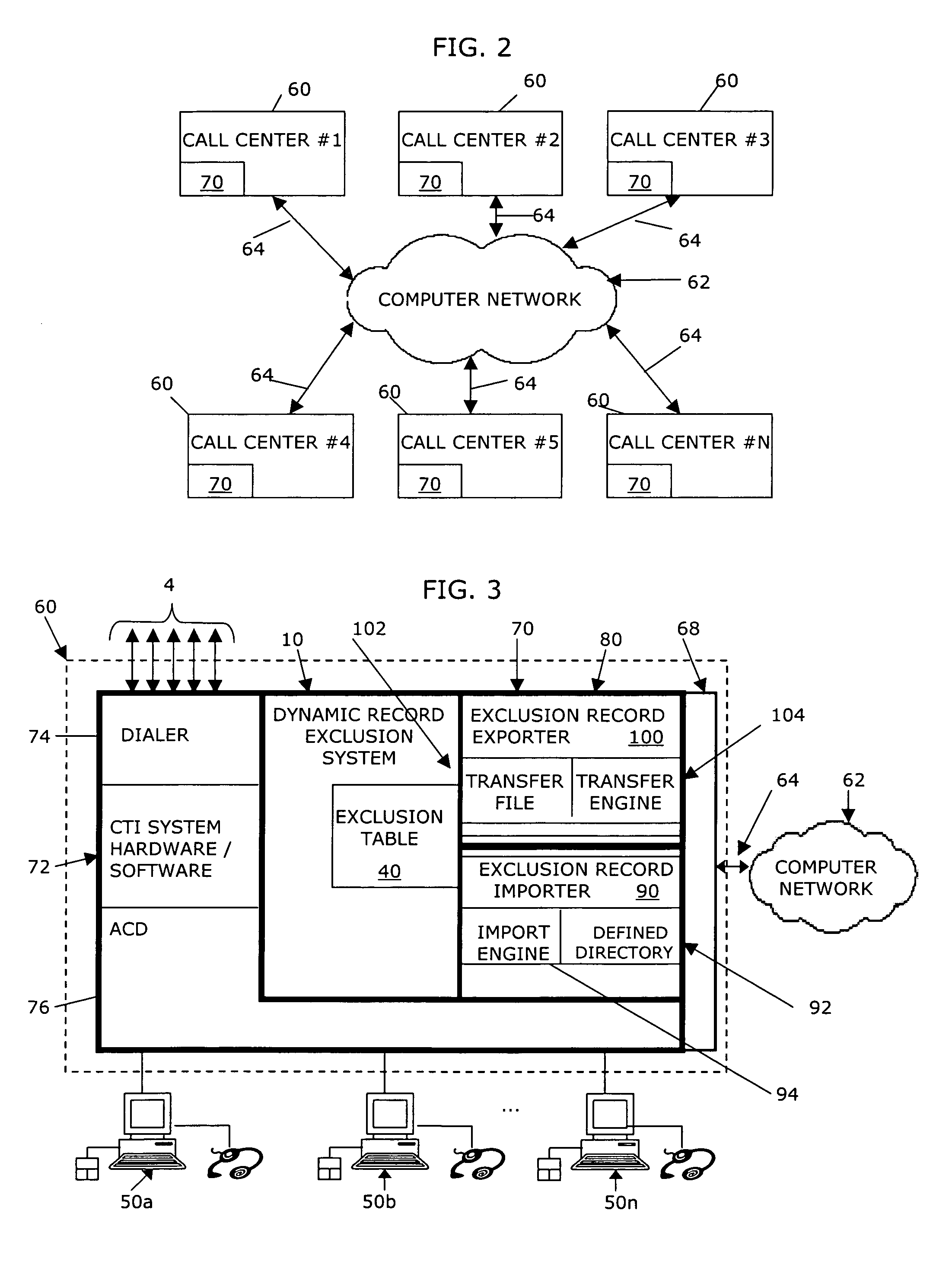

System and method of propagating exclusion records in a networked computer telephony integration system

A system and method of propagating exclusion records between a plurality of networked call centers is provided. Each call center includes a CTI system having a dynamic data record exclusion system. The system includes an exclusion record exporter and an exclusion record importer interfacing the dynamic data record exclusion system at each networked CTI system, which export and import exclusion records that are generated at one CTI system to the remaining networked CTI systems. The method begins by maintaining at least one exclusion table including at least one exclusion record in a first call center's dynamic data record exclusion system. Then, the exclusion records, along with a list of the networked call centers to which the exclusion records should be sent, are sent to an exclusion record exporter, where they are saved in a transfer file. The exclusion record exporter then transfers each transfer file to a defined directory at an exclusion record importer at at least one other networked call center. Each exclusion record importer searches its defined directory and, if a new transfer file is identified, copies the exclusion records to an appropriate exclusion table in that call center's dynamic data record exclusion system.

Owner:WILMINGTON TRUST NAT ASSOC AS ADMINISTATIVE AGENT +1

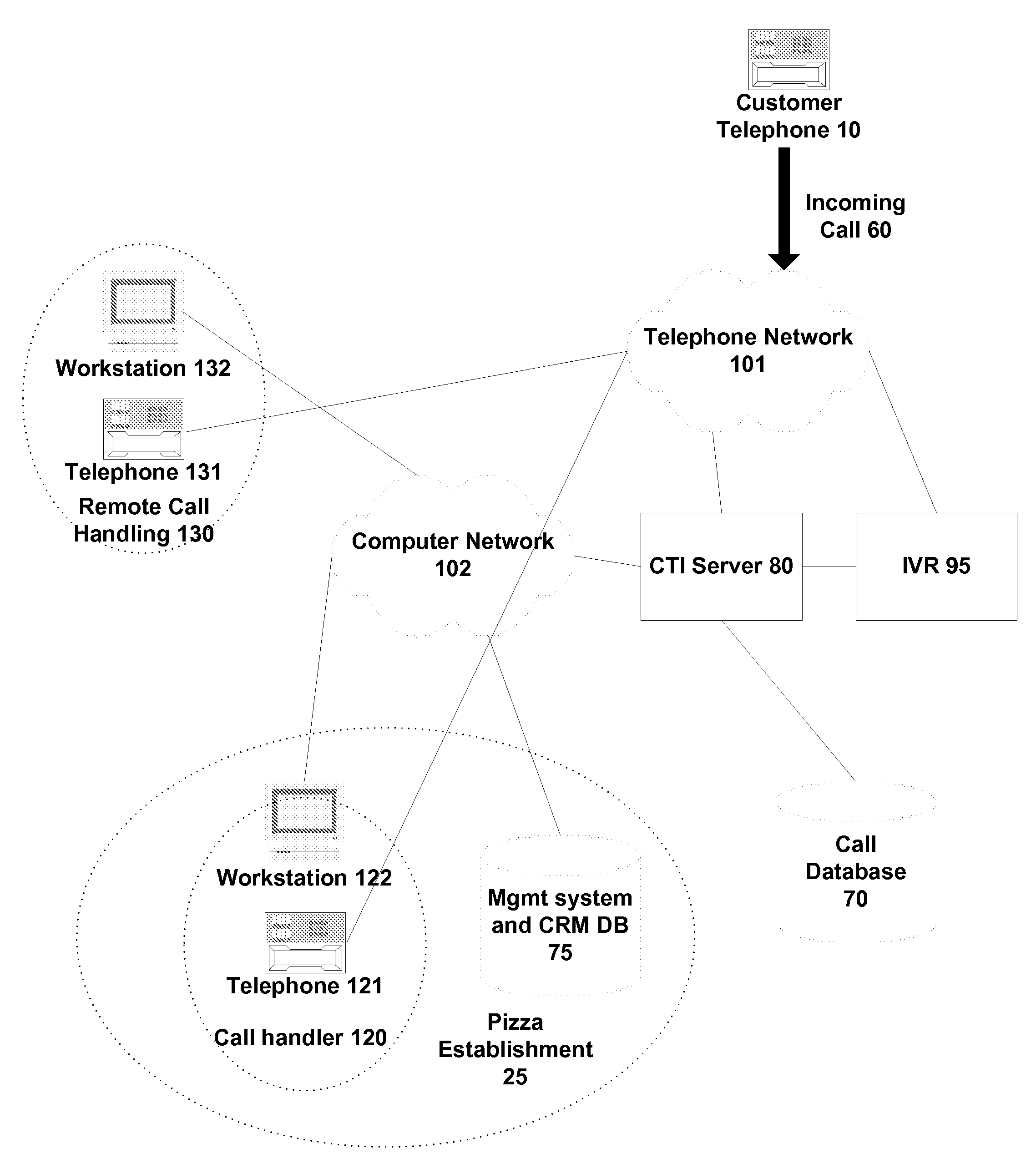

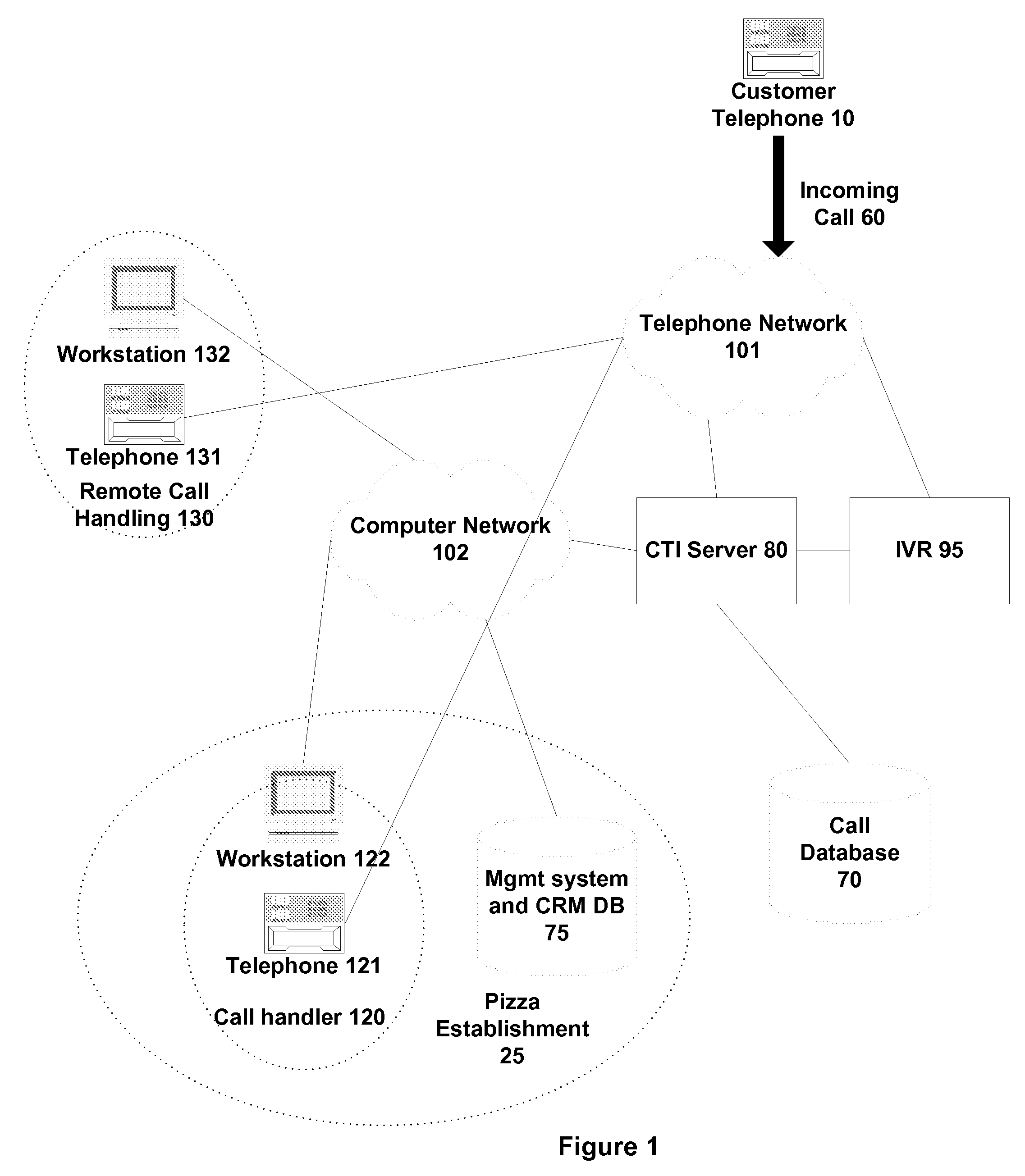

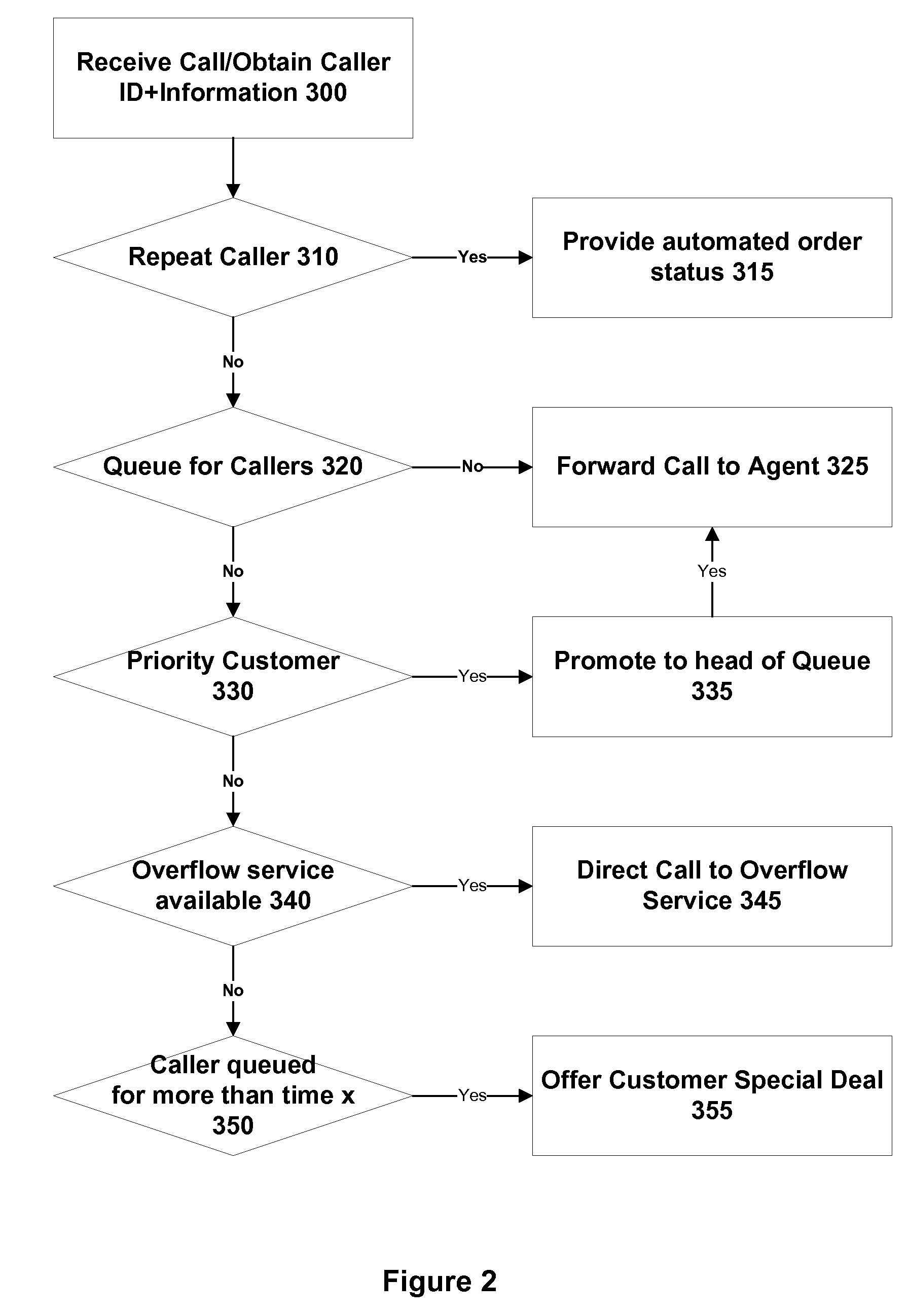

Method and apparatus for handling a telephone call

ActiveUS20090116636A1Fast response timeHarder to mirrorAutomatic call-answering/message-recording/conversation-recordingManual exchangesPriority callClient data

One embodiment of the invention provides a method of handling a telephone call. The method includes providing a multi-tenanted computer-telephony integration (CTI) server. The different tenants correspond to various outlets for one or more product or service offerings. The CTI server is located outside the customer premises for the various outlets. The method further includes receiving a call directed to one of the outlets and using CLI for the call by the CTI server to identify the calling party and a customer profile for the calling party. The customer profile is based on previous orders. The method further includes queuing the call within the network if it is determined that the outlet is unable to currently service the call, and forwarding the call to the outlet to process the call. The CTI server uses the customer profile for providing priority call handling treatment for loyal customers.

Owner:VONAGE BUSINESS LIMITED

One number, intelligent call processing system

InactiveUS20070127657A1Expand coverageShorten the timeSpecial service for subscribersCalled number recording/indicationTelecommunications networkHandling system

Owner:MUREX SECURITIES

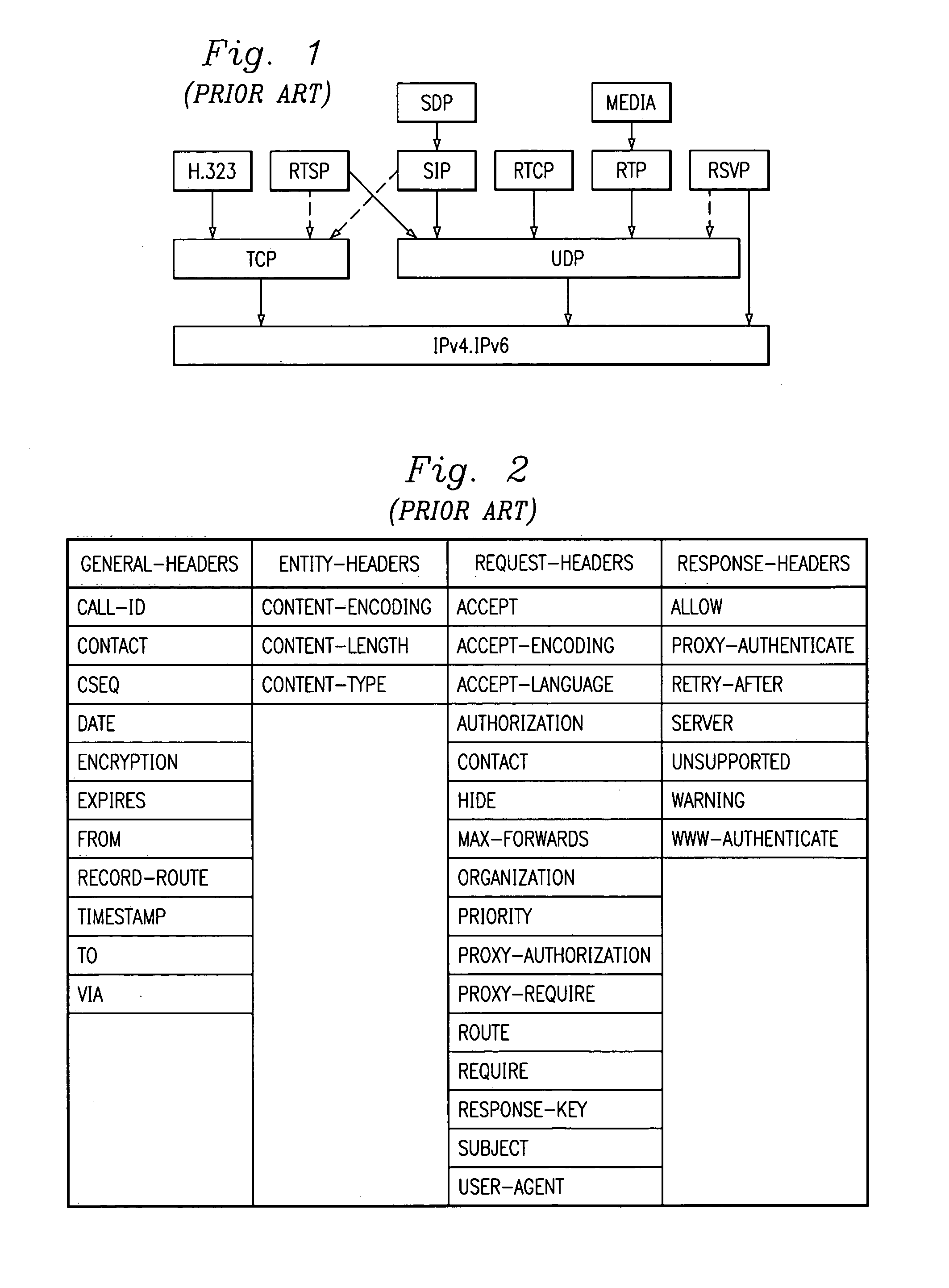

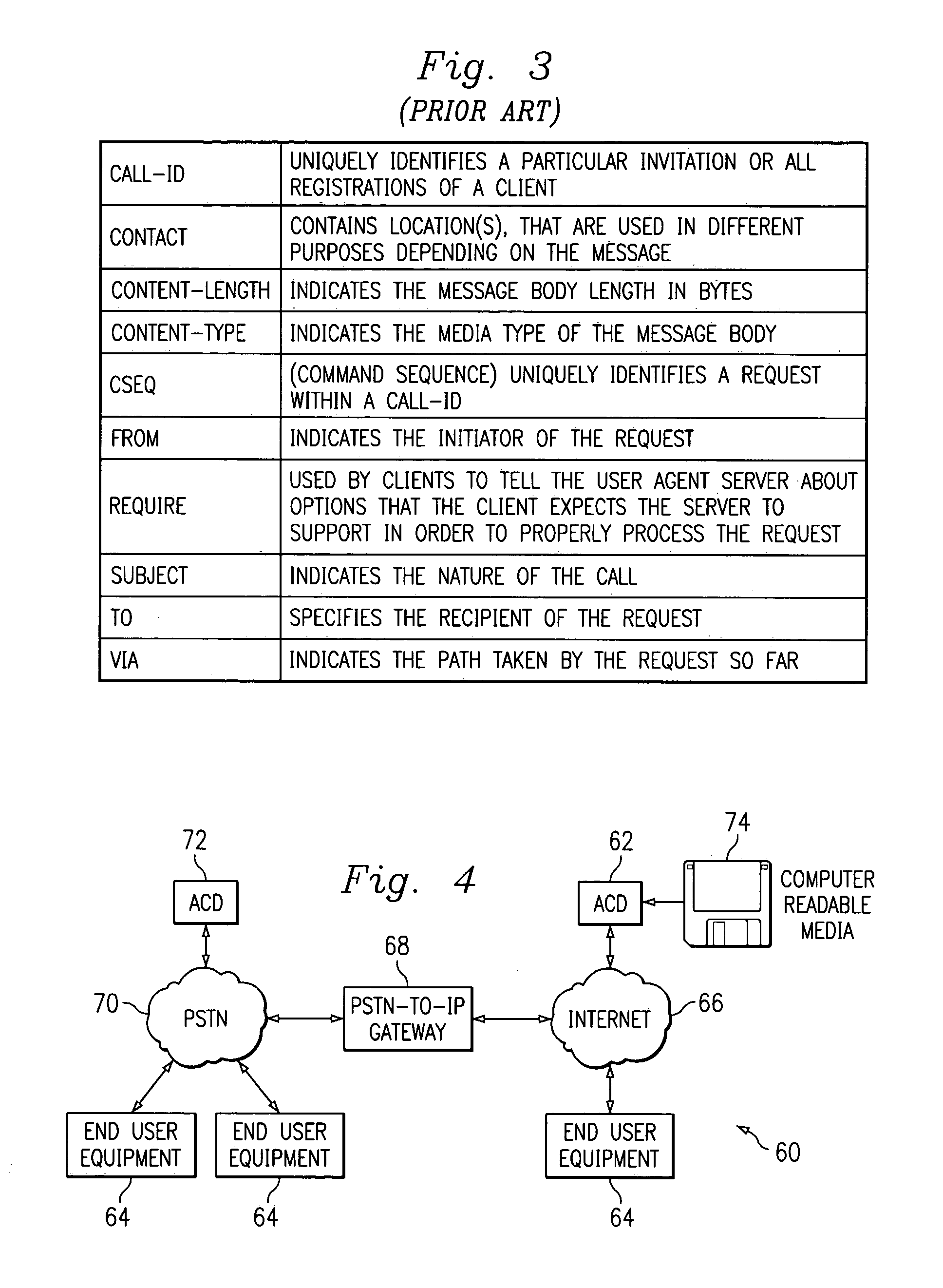

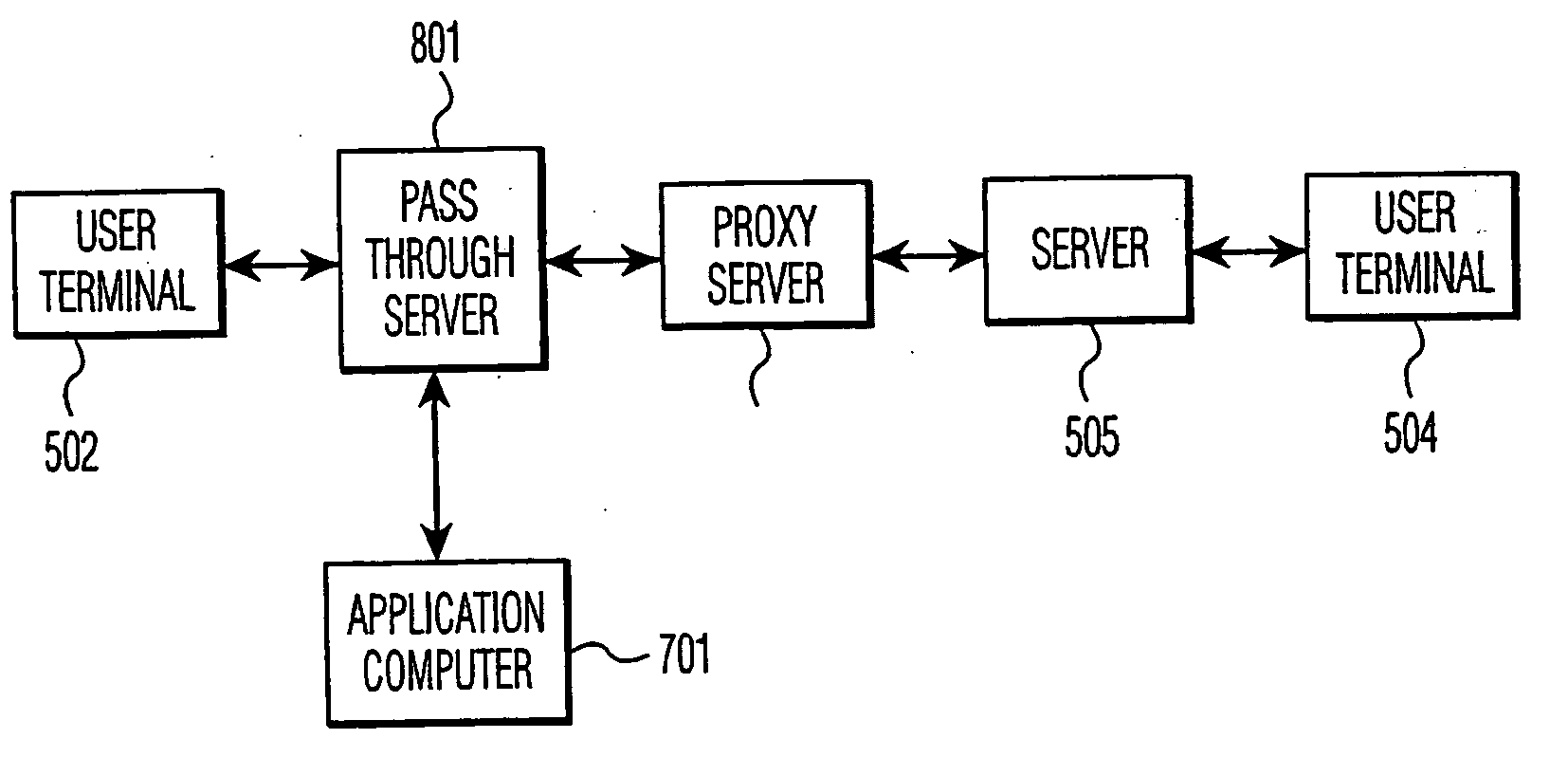

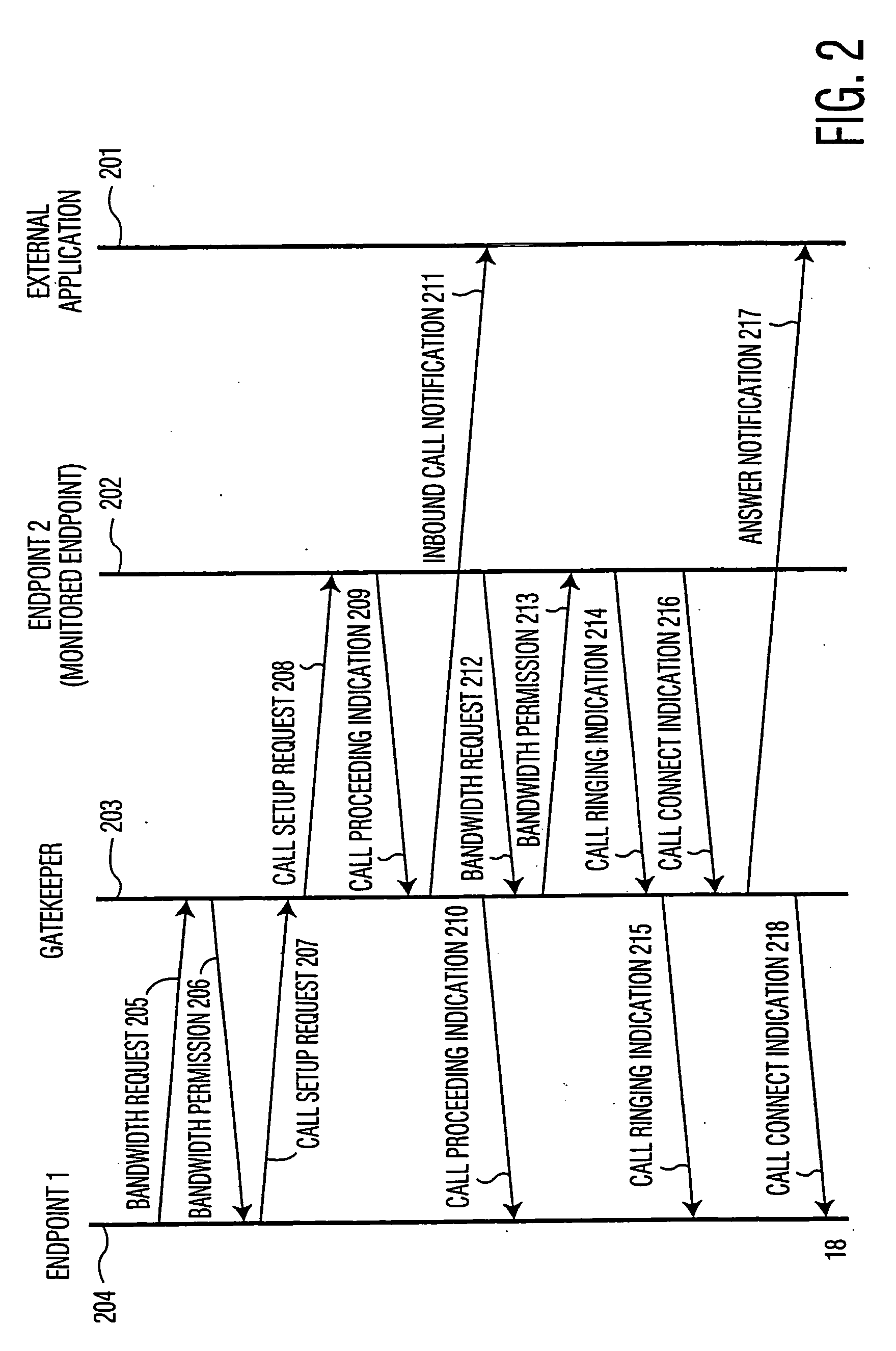

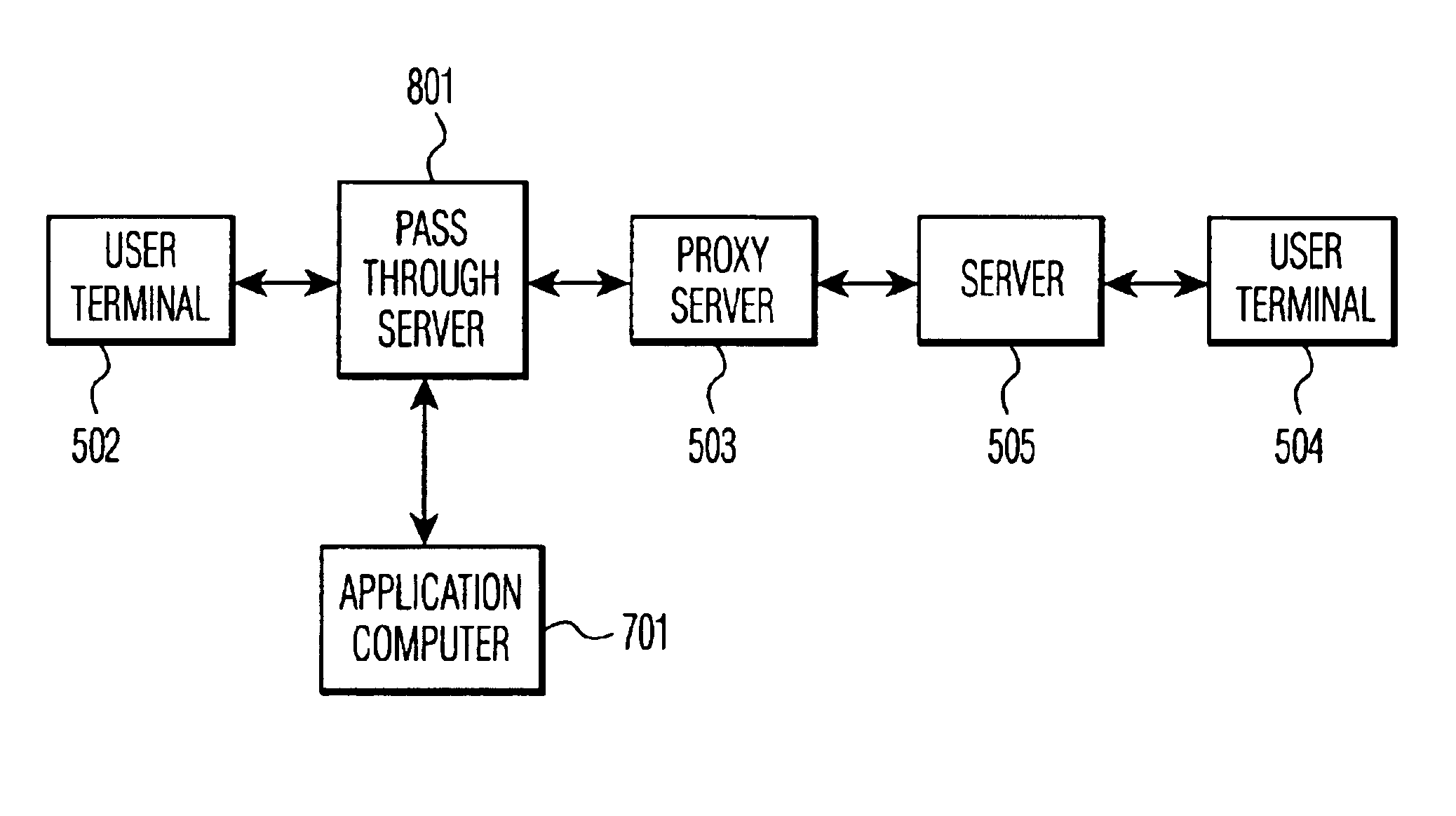

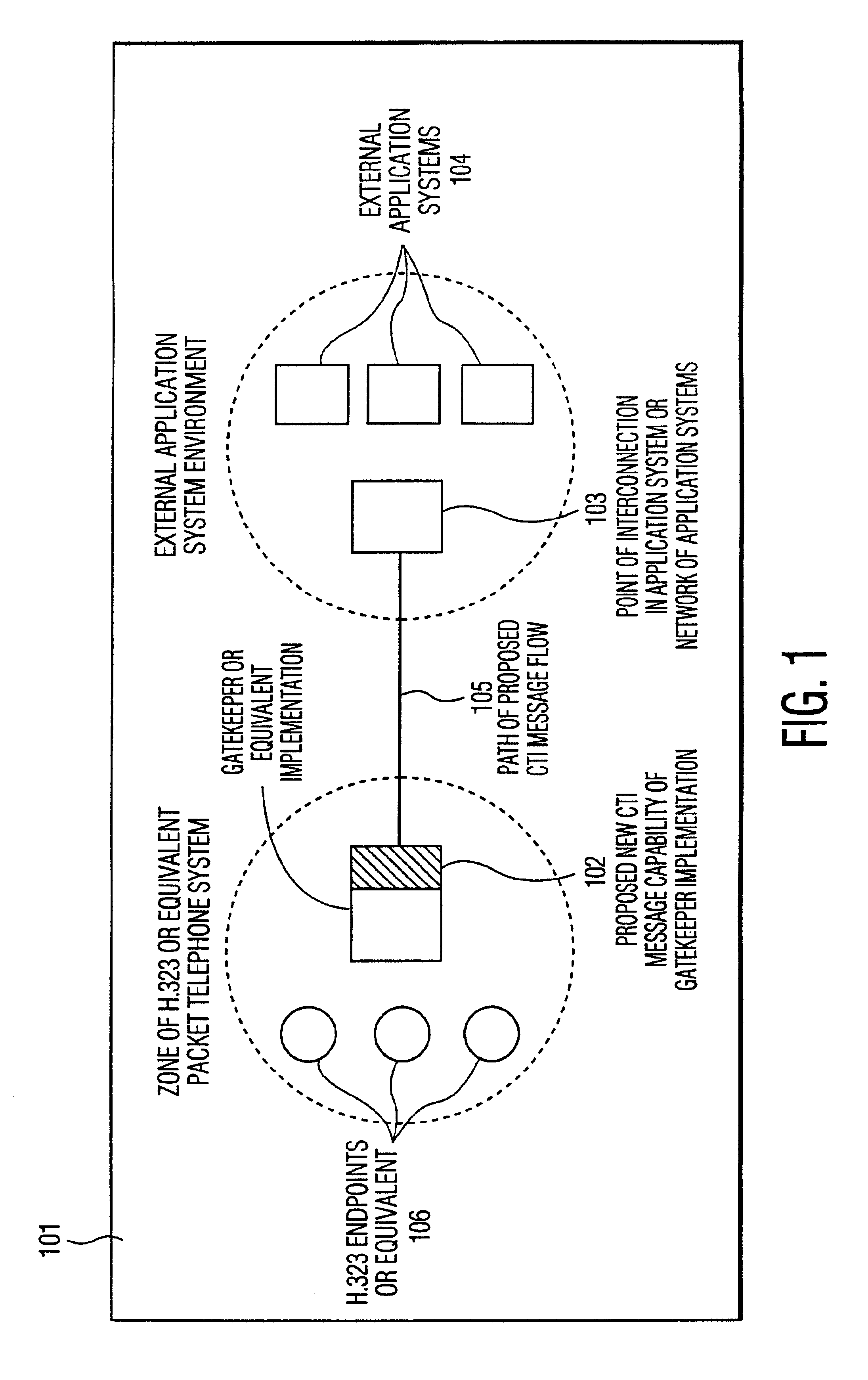

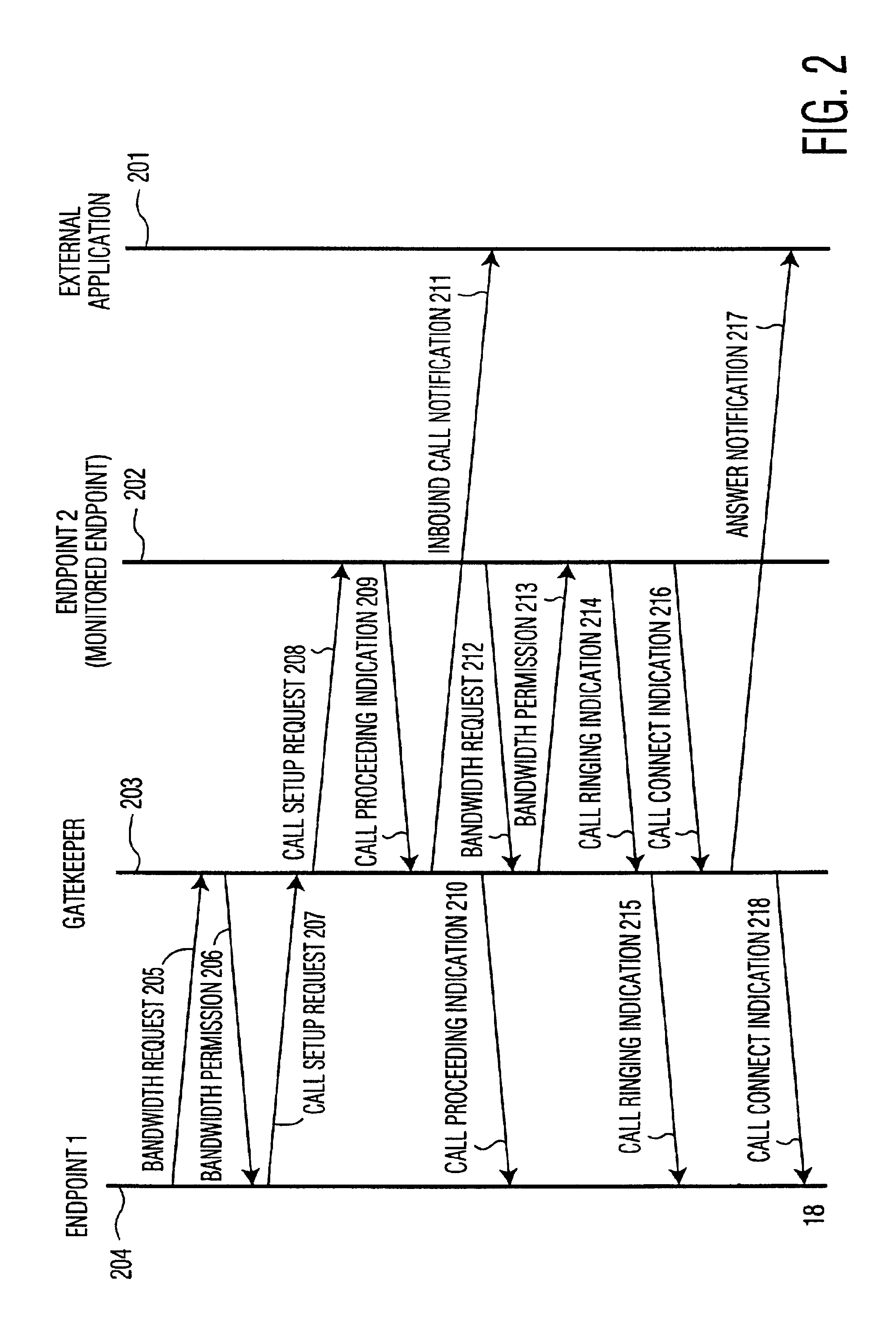

Apparatus and method for computer telephone integration in packet switched telephone networks

InactiveUS20050122964A1Application programming interface detailsSpecial service for subscribersSession Initiation ProtocolApplication computers

A computer telephony interface (CTI) applications computer interfaces to a Internet telephony system which utilizes, preferably, the session initiation protocol (SIP). In one preferred technique, an additional pass through server is added to connect end users to their associated SIP proxy server, and to connect a CTI applications computer to the system.

Owner:INTEL CORP

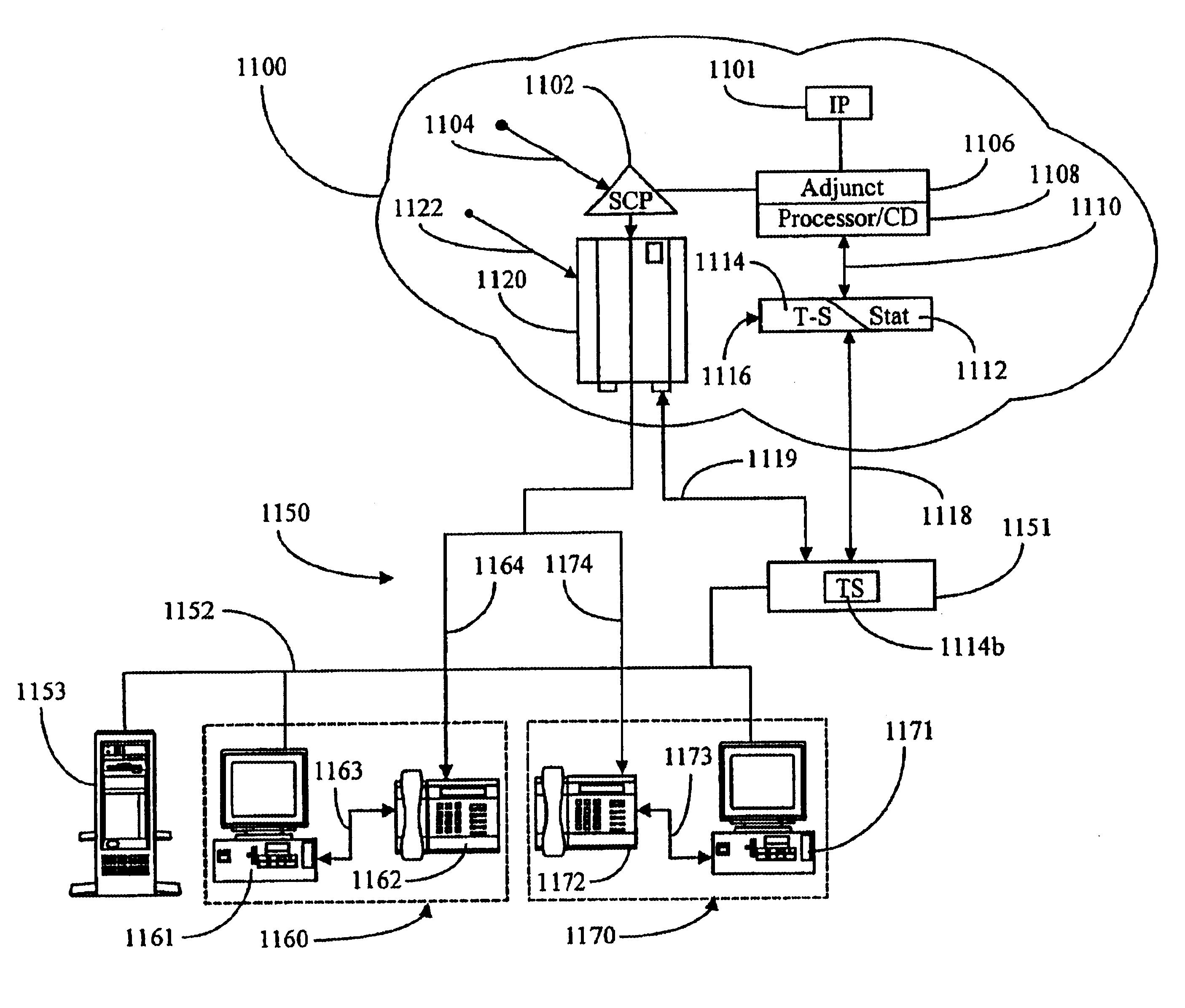

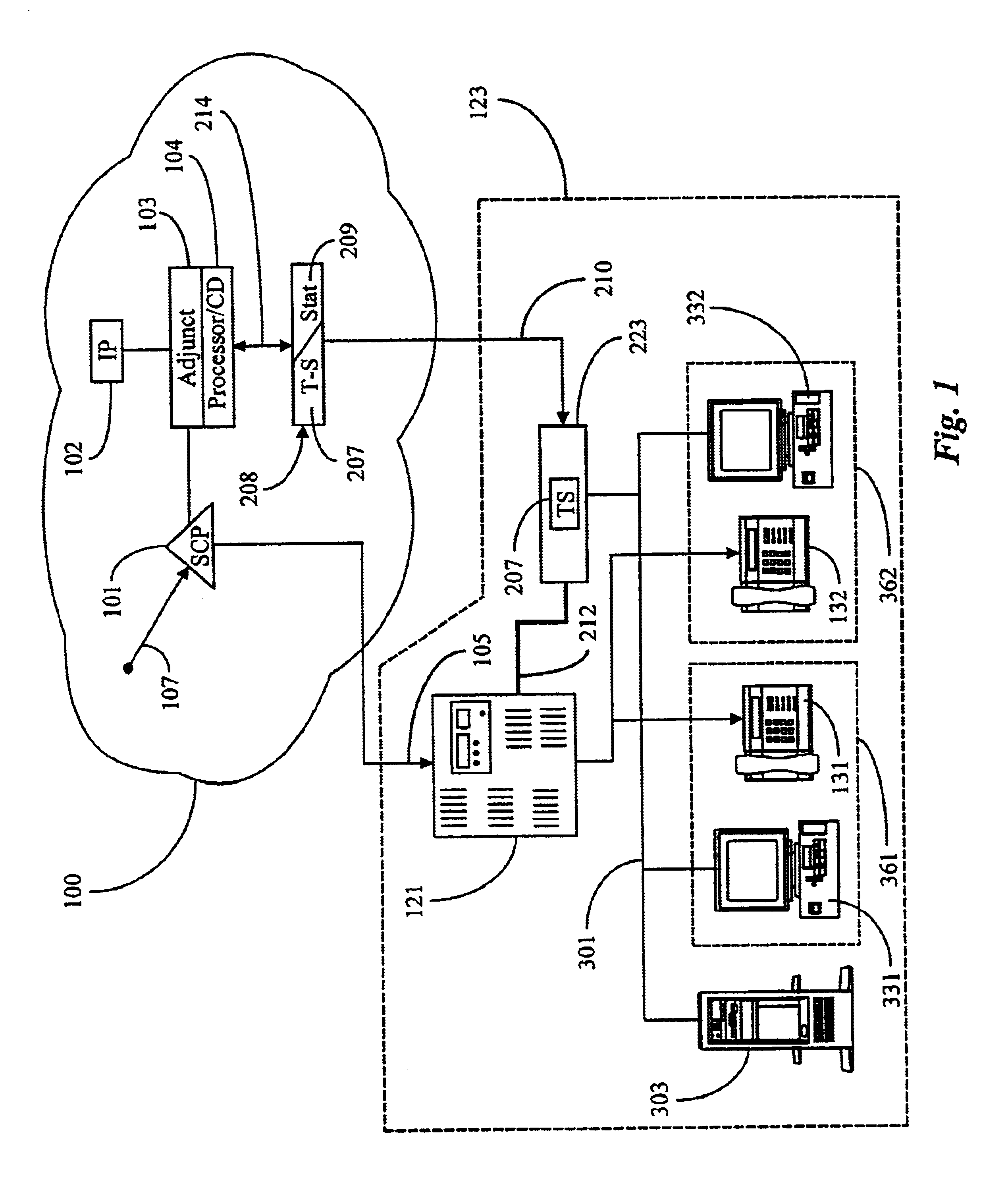

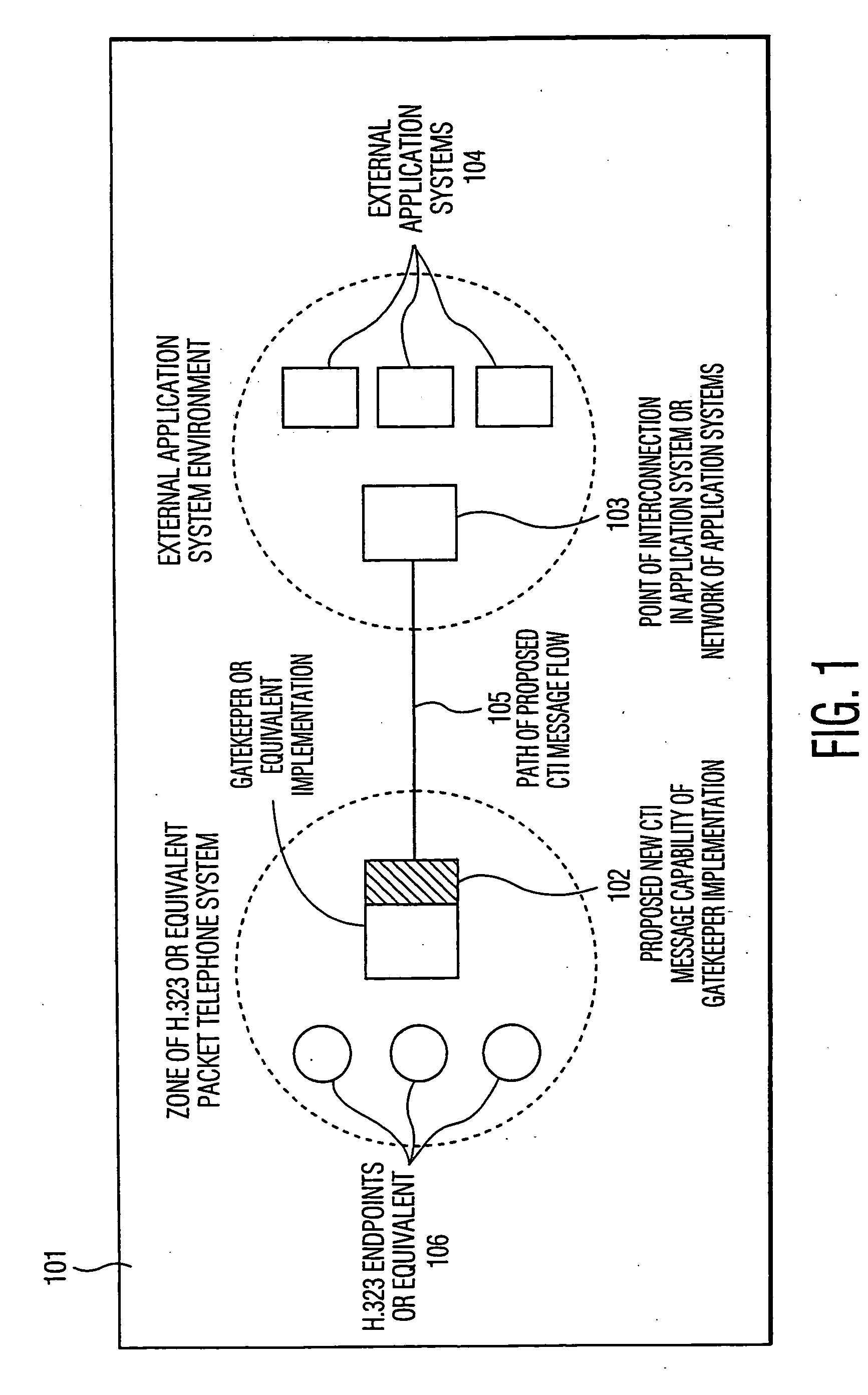

Telephony intelligence in a data packet network

A packet-data network is made intelligent in the sense of a connection-oriented, switched telephony (COST) network by enhancing one or more interconnected IP routers in the network with computer-telephony integration (CTI) processors executing CTI applications. No-charge-to-calling-party IP addresses are assigned and sponsored by various enterprises, who may also maintain call centers having at least one CTI-enhanced IP router connected to the network, and agent stations having IP telephones connected to the call-center-located IP router. With appropriate software and the CTI link to IP routers the performance of well-known conventional telephone systems may be provided in packet networks like the Internet.

Owner:GENESYS TELECOMM LAB INC AS GRANTOR +3

Apparatus and method for computer telephone integration in packet switched telephone networks

InactiveUS6856618B2Application programming interface detailsSpecial service for subscribersSession Initiation ProtocolApplication computers

A computer telephony interface (CTI) applications computer interfaces to a Internet telephony system which utilizes, preferably, the session initiation protocol (SIP). In one preferred technique, an additional pass through server is added to connect end users to their associated SIP proxy server, and to connect a CTI applications computer to the system.

Owner:INTEL CORP

Telephony Intelligence in a Data Packet Network

InactiveUS20080049737A1Multiplex system selection arrangementsIntelligent networksIp routerIp address

A packet-data network is made intelligent in the sense of a connection-oriented, switched telephony (COST) network by enhancing one or more interconnected IP routers in the network with computer-telephony integration (CTI) processors executing CTI applications. No-charge-to-calling-party IP addresses are assigned and sponsored by various enterprises, who may also maintain call centers having at least one CTI-enhanced IP router connected to the network, and agent stations having IP telephones connected to the call-center-located IP router. With appropriate software and the CTI link to IP routers the performance of well-known conventional telephone systems may be provided in packet networks like the Internet.

Owner:GENESYS TELECOMM LAB INC AS GRANTOR +3

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com