Patents

Literature

68 results about "Financial interest" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Financial Interest (Gaming Law) Law and Legal Definition. Financial interest generally refers to any pecuniary interests gained like salary or other payments for services or equity interests like stocks, stock options, intellectual property rights and the like.

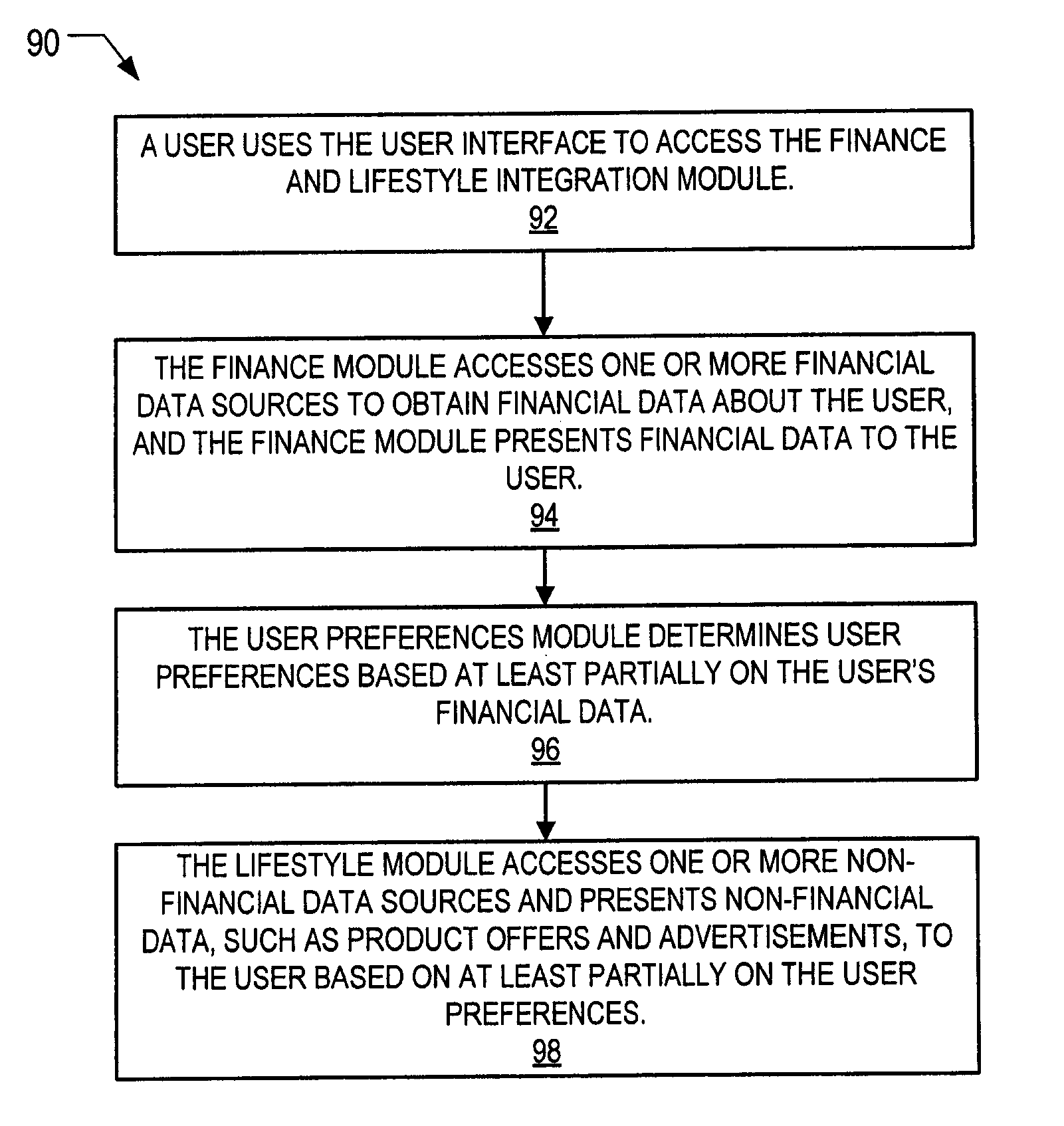

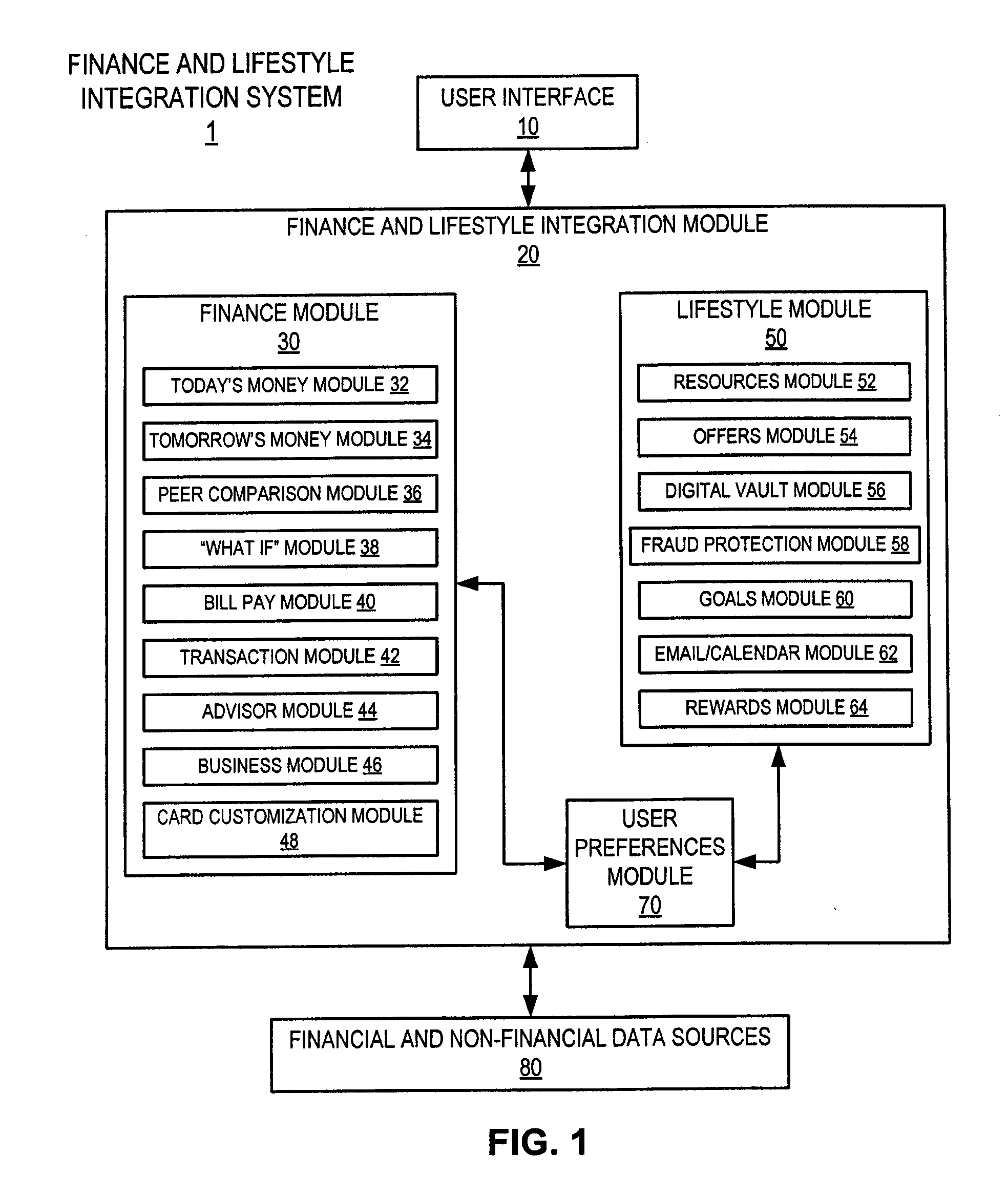

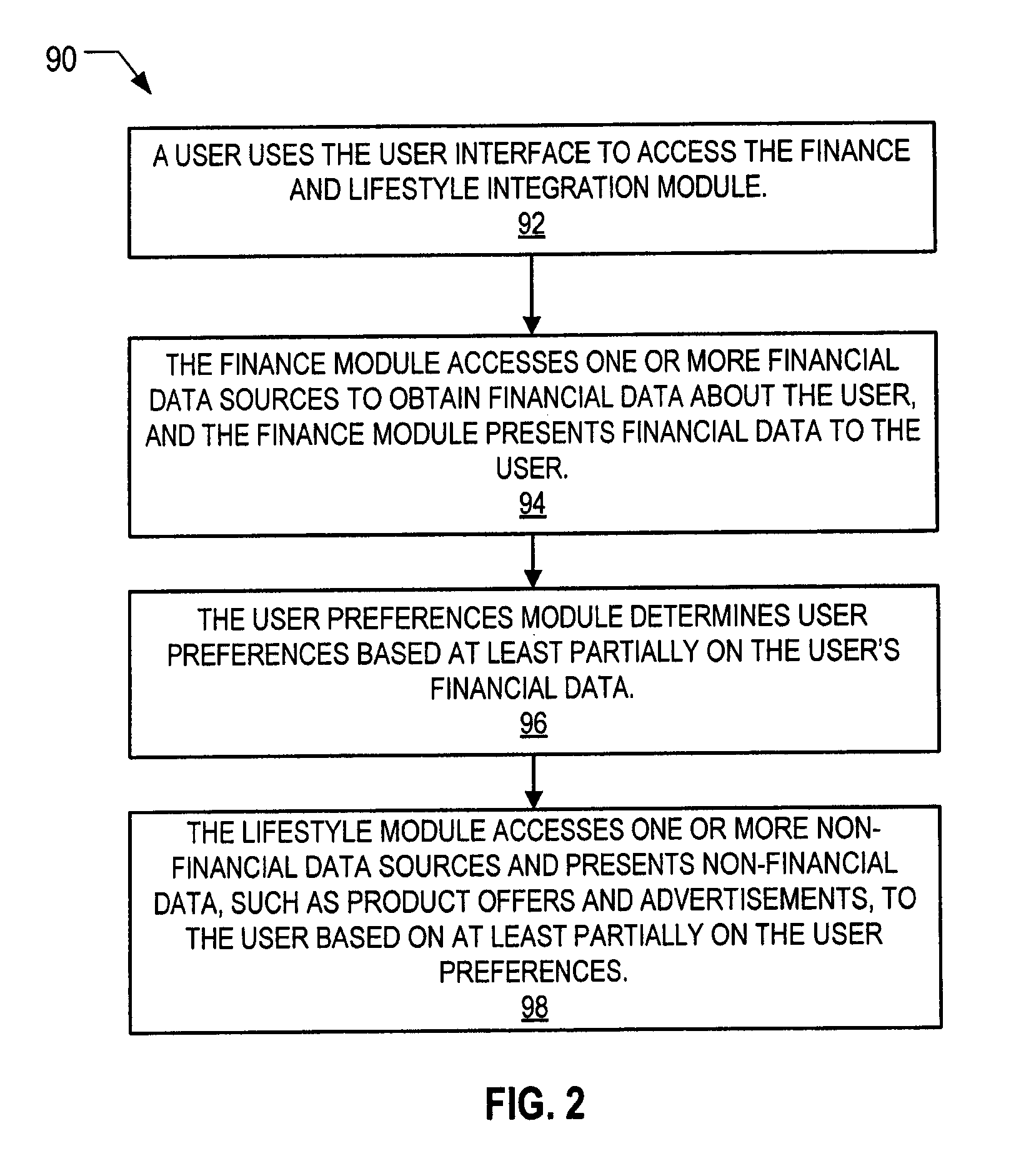

Tools for relating financial and non-financial interests

InactiveUS20100100424A1Improve customer serviceGood serviceFinancePayment architectureGraphicsGraphical user interface

Embodiments of the invention provide an apparatus having processor configured to: (a) provide a user with access to the user's financial account via a graphical user interface; (b) determine user preferences based at least partially on the user's financial information; and (c) provide non-financial content to the user via the graphical user interface and based at least partially on the user preferences. In one embodiment, the processor is configured to determine user preferences by determining trends in the user's financial information. In one embodiment, the processor is configured to determine user preferences by distinguishing between user financial transactions that are regular and user financial transactions that are ad hoc.

Owner:BANK OF AMERICA CORP

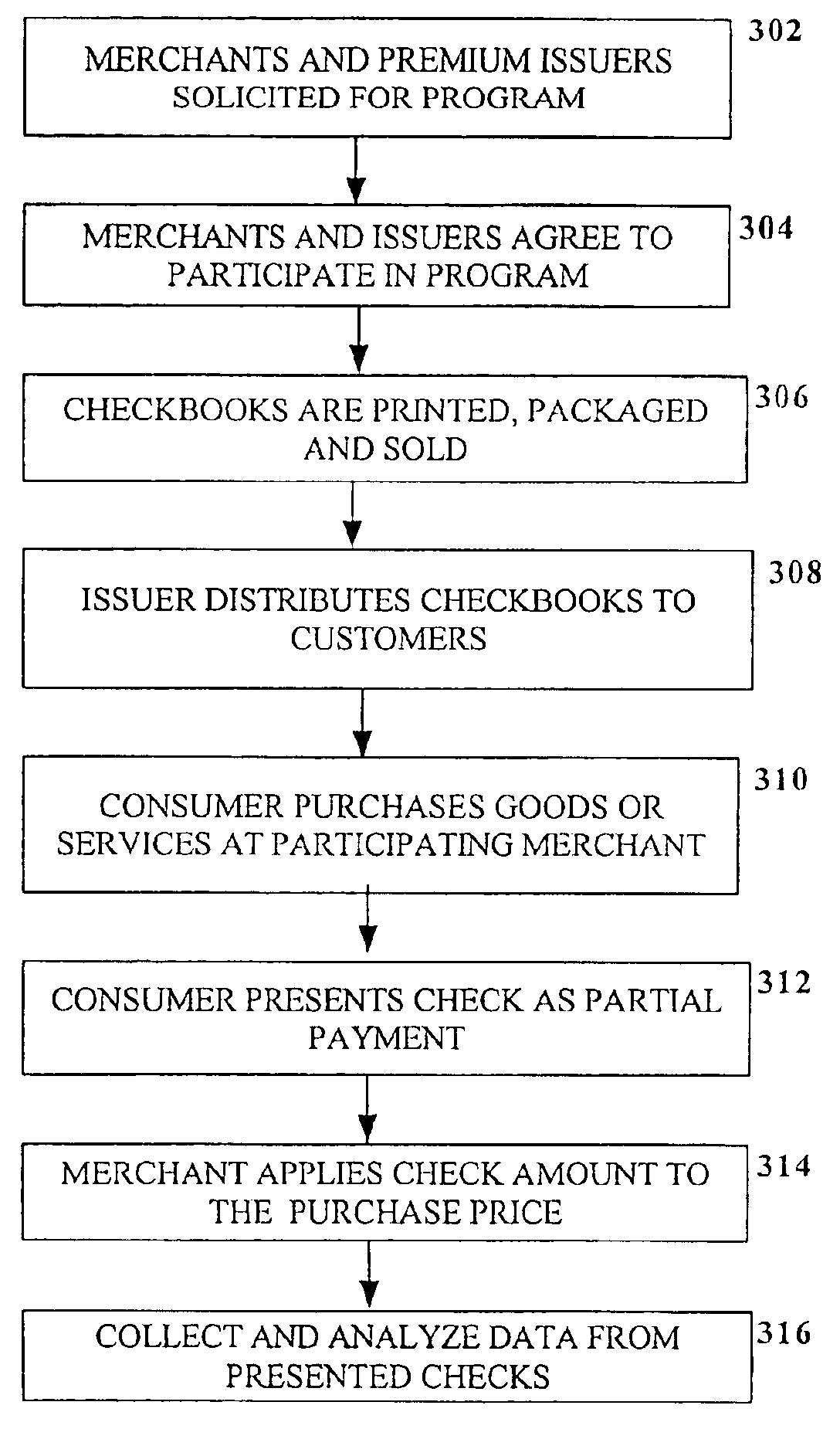

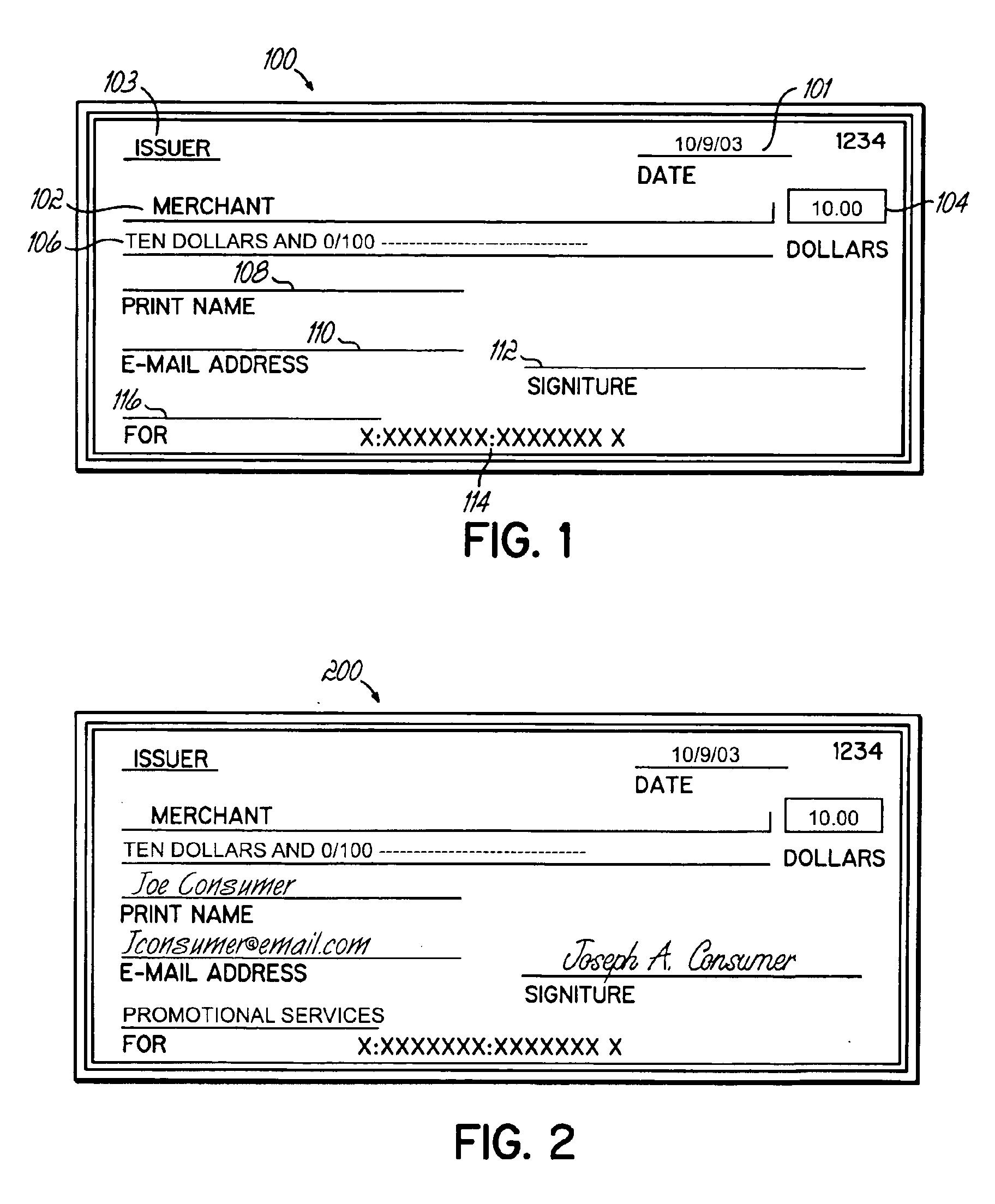

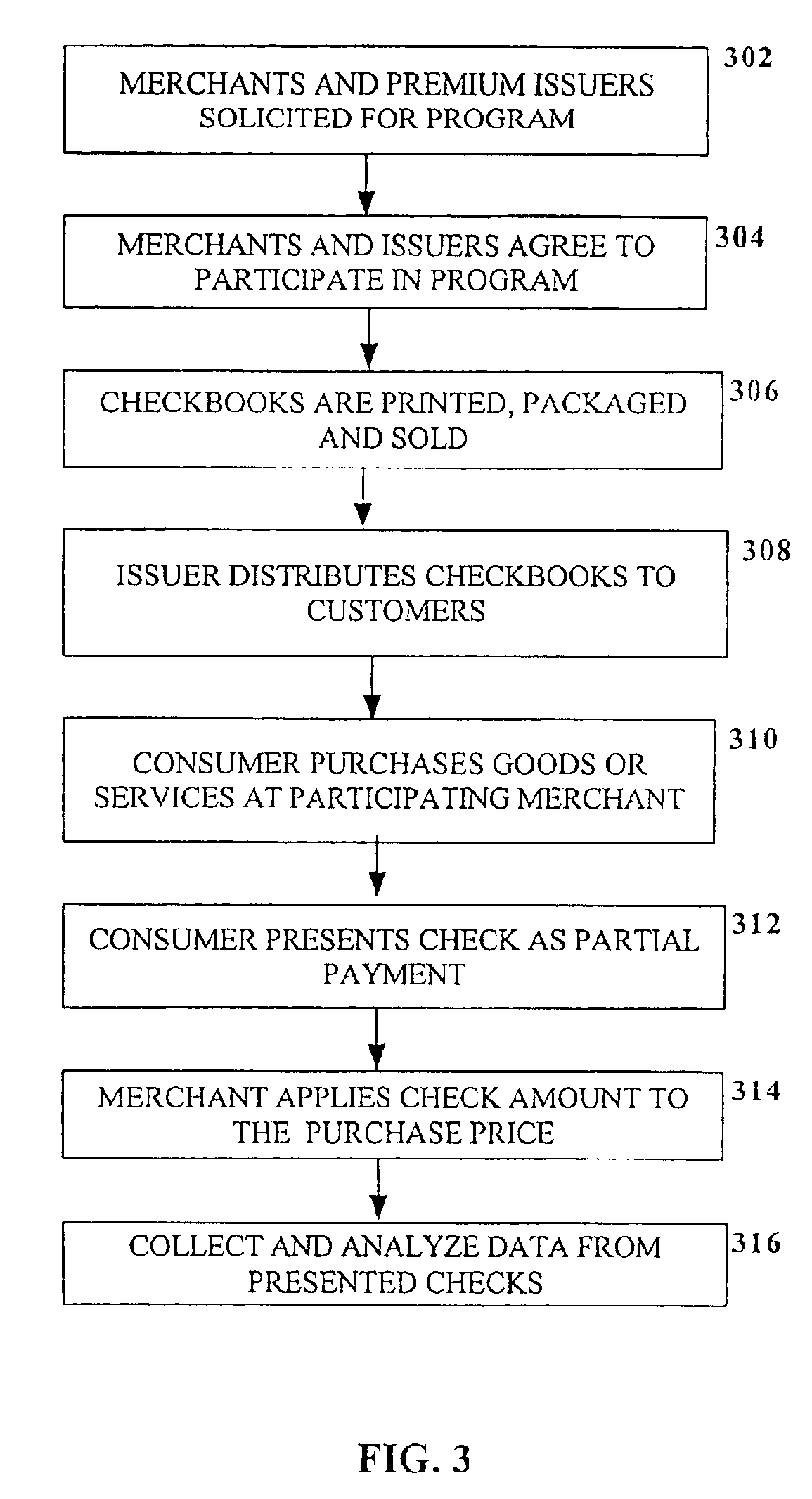

Method and system for providing a check premium

InactiveUS6896188B1Low costEasy to useOther printing matterRecord carriers used with machinesPaymentCheque

An issuer distributes to its customers a premium to attract and retain consumers. The premium comprises a checkbook having a number of partially pre-printed checks from a number of merchants. The checks are redeemable at the merchants for a predetermined amount of money towards a purchase. The consumer fills out certain information when presenting the check so that the transaction appears to be performed using a check as the method of payment while the consumer is still able to receive the financial benefit often accompanying the use of coupons. The remaining transaction amount is made using conventional payment methods.

Owner:TRANSWORLD BENEFITS INT

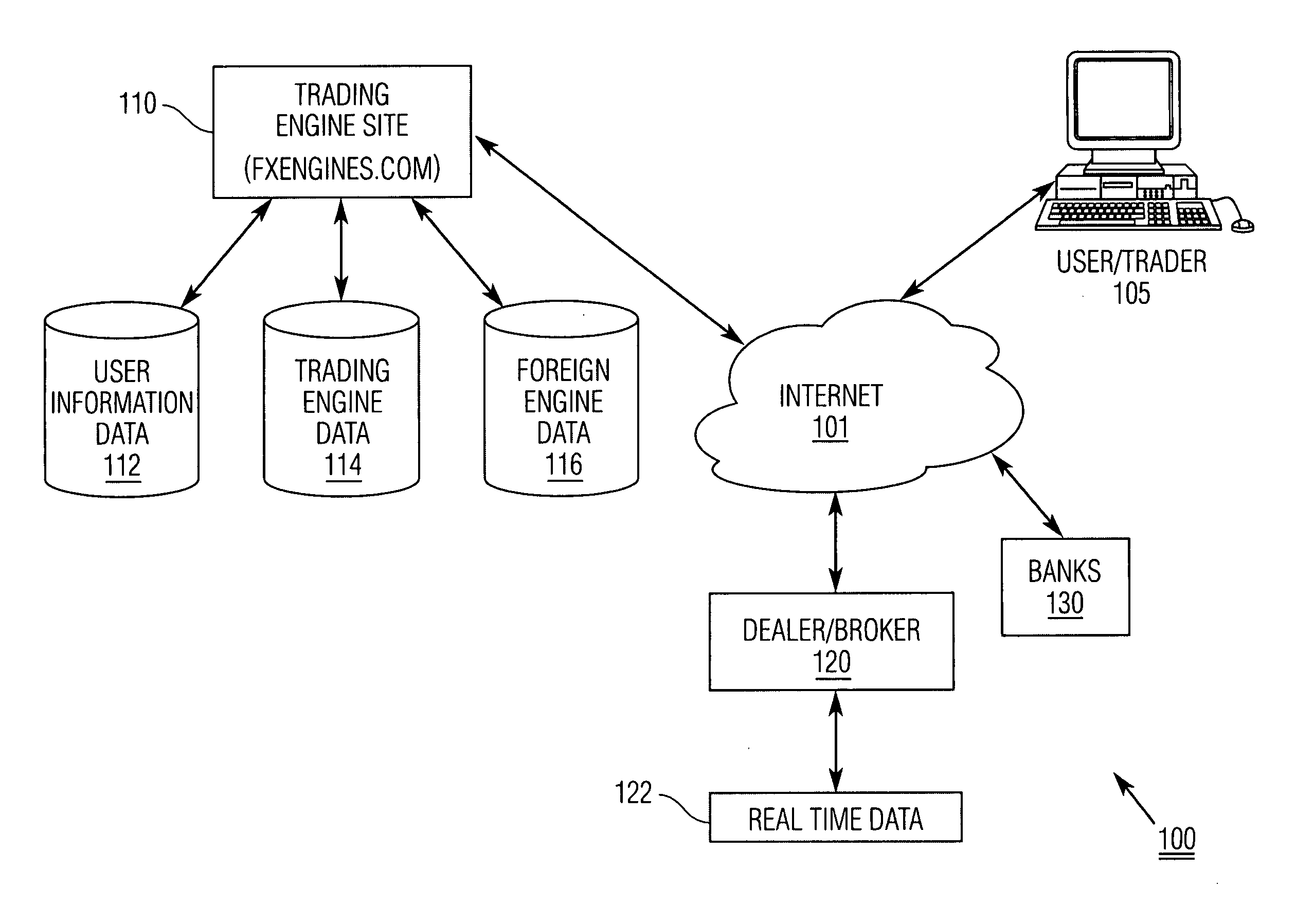

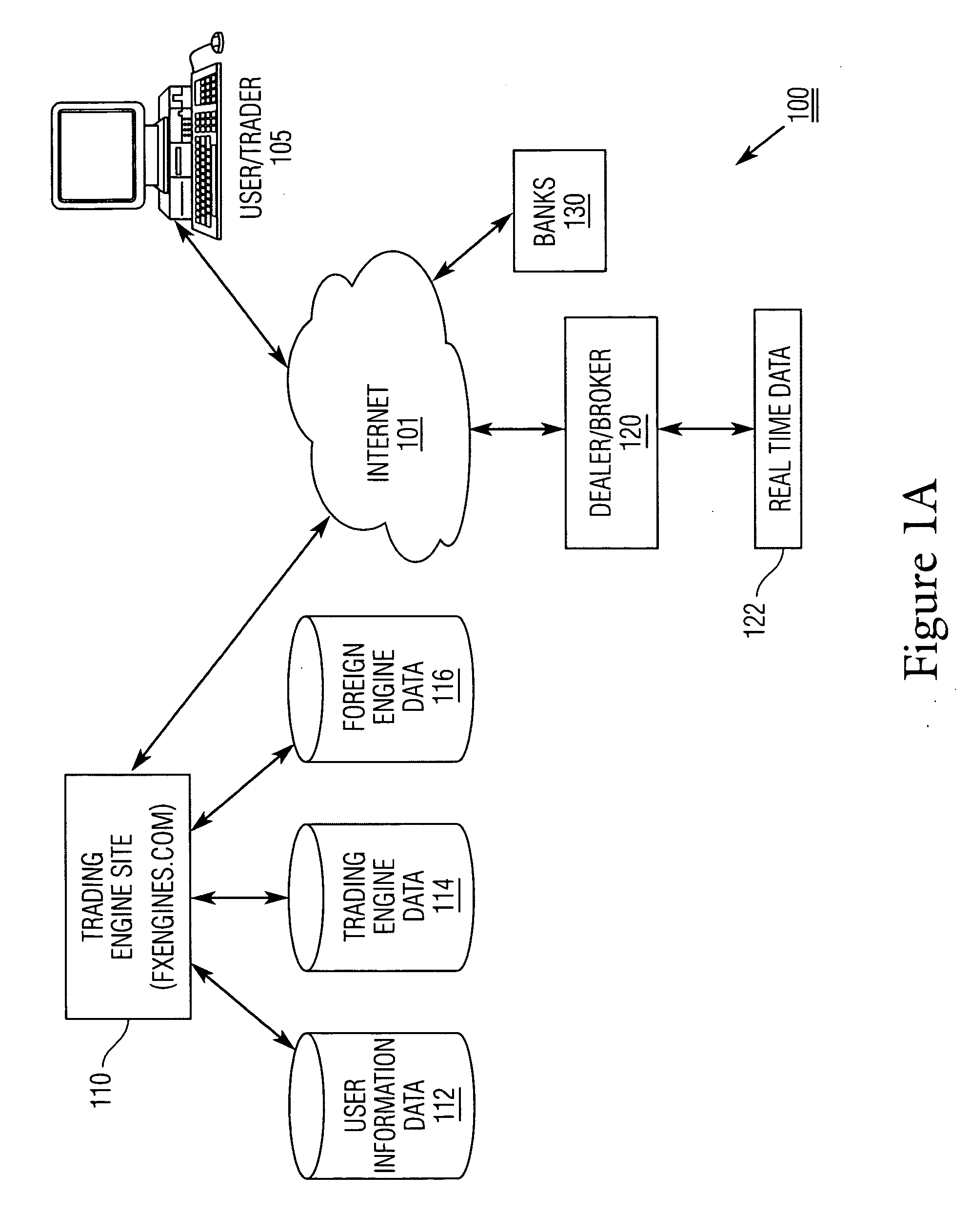

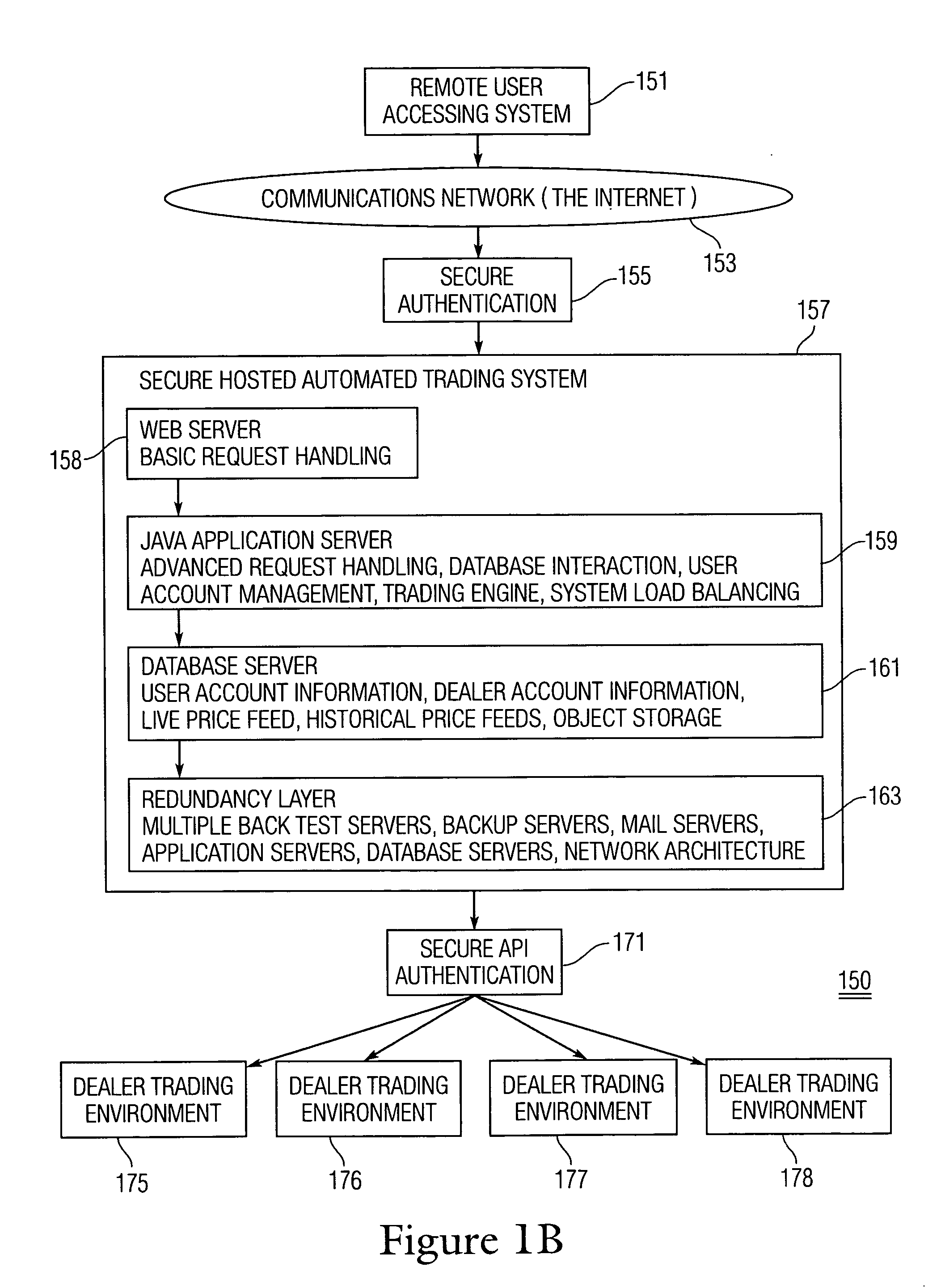

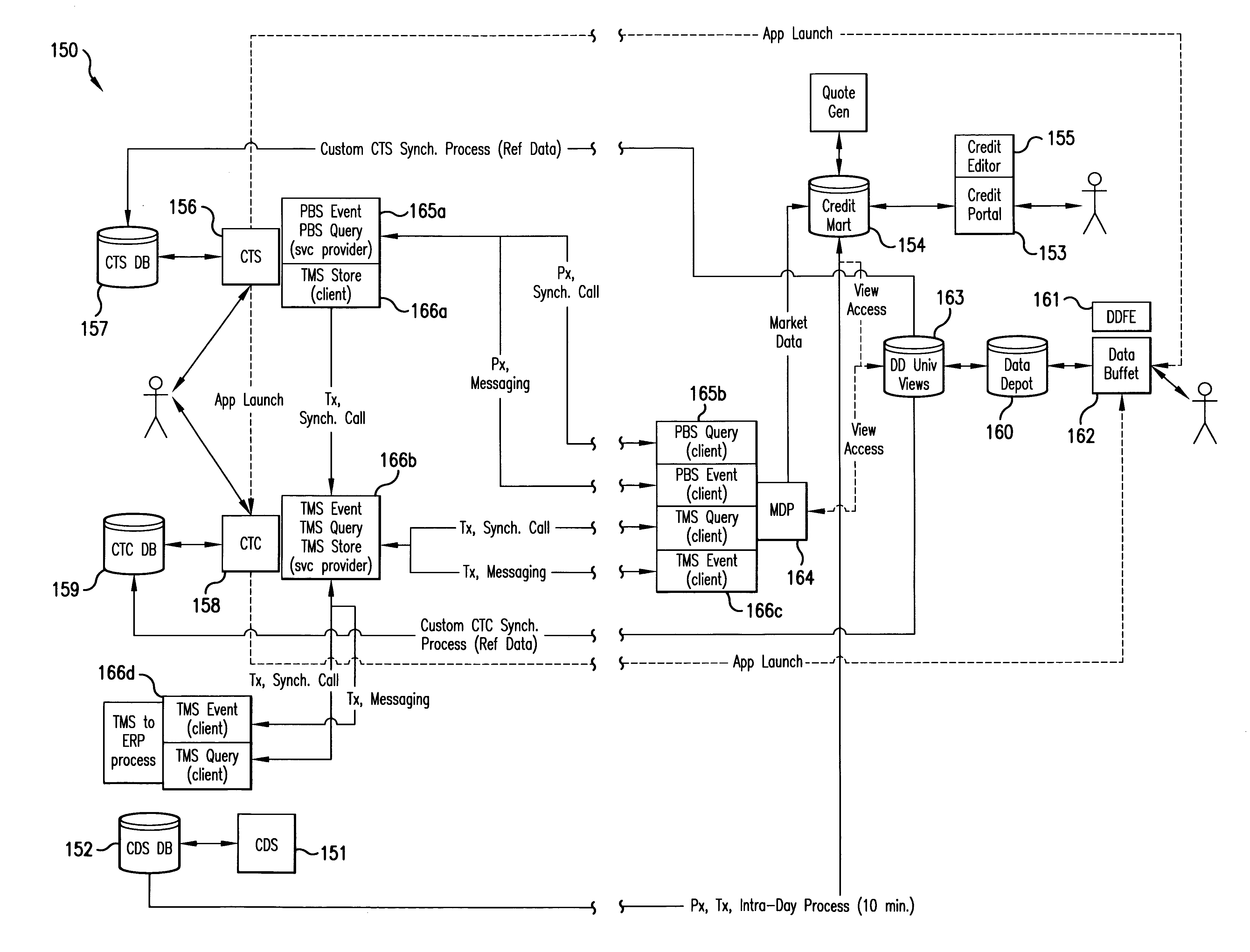

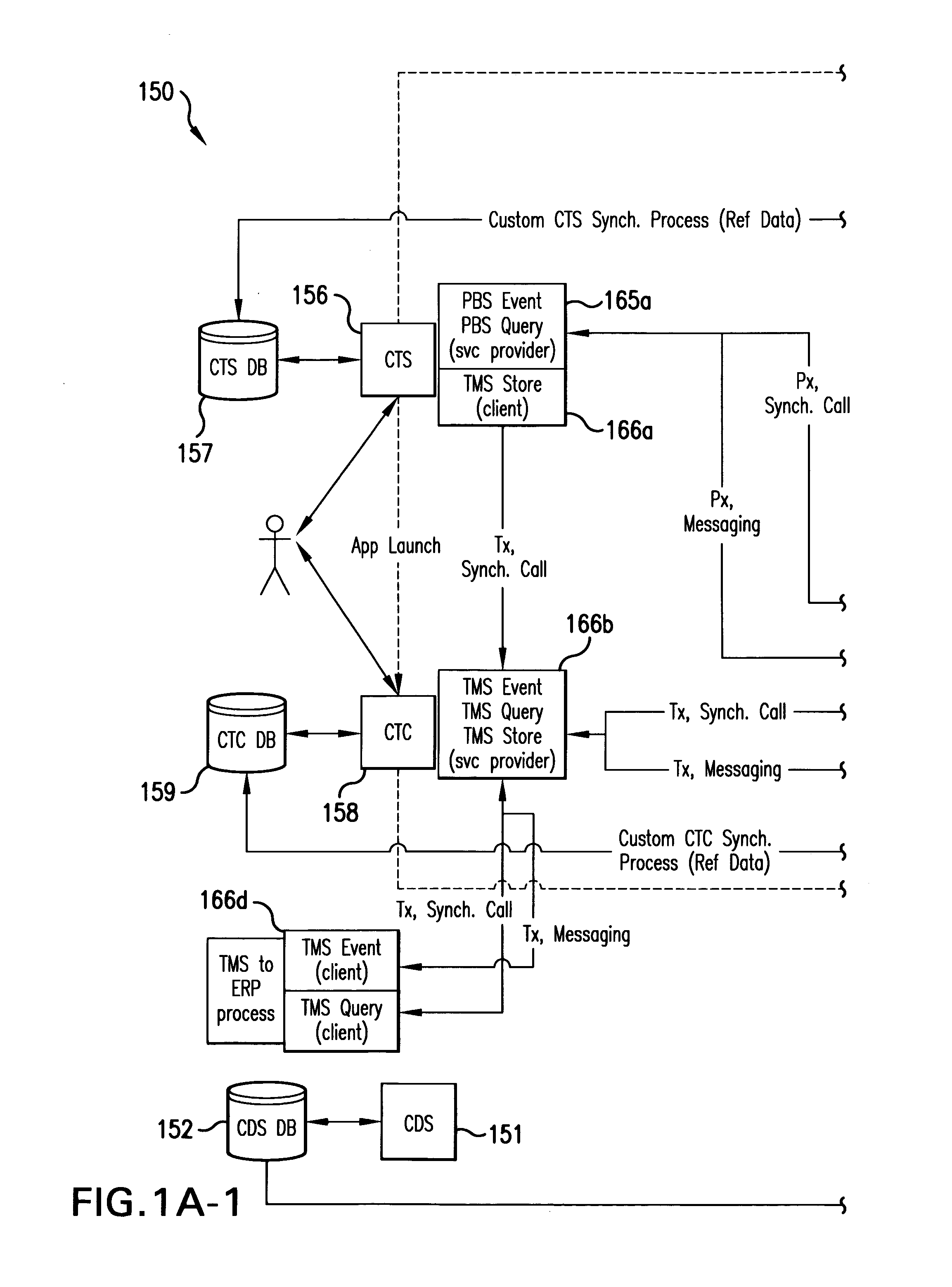

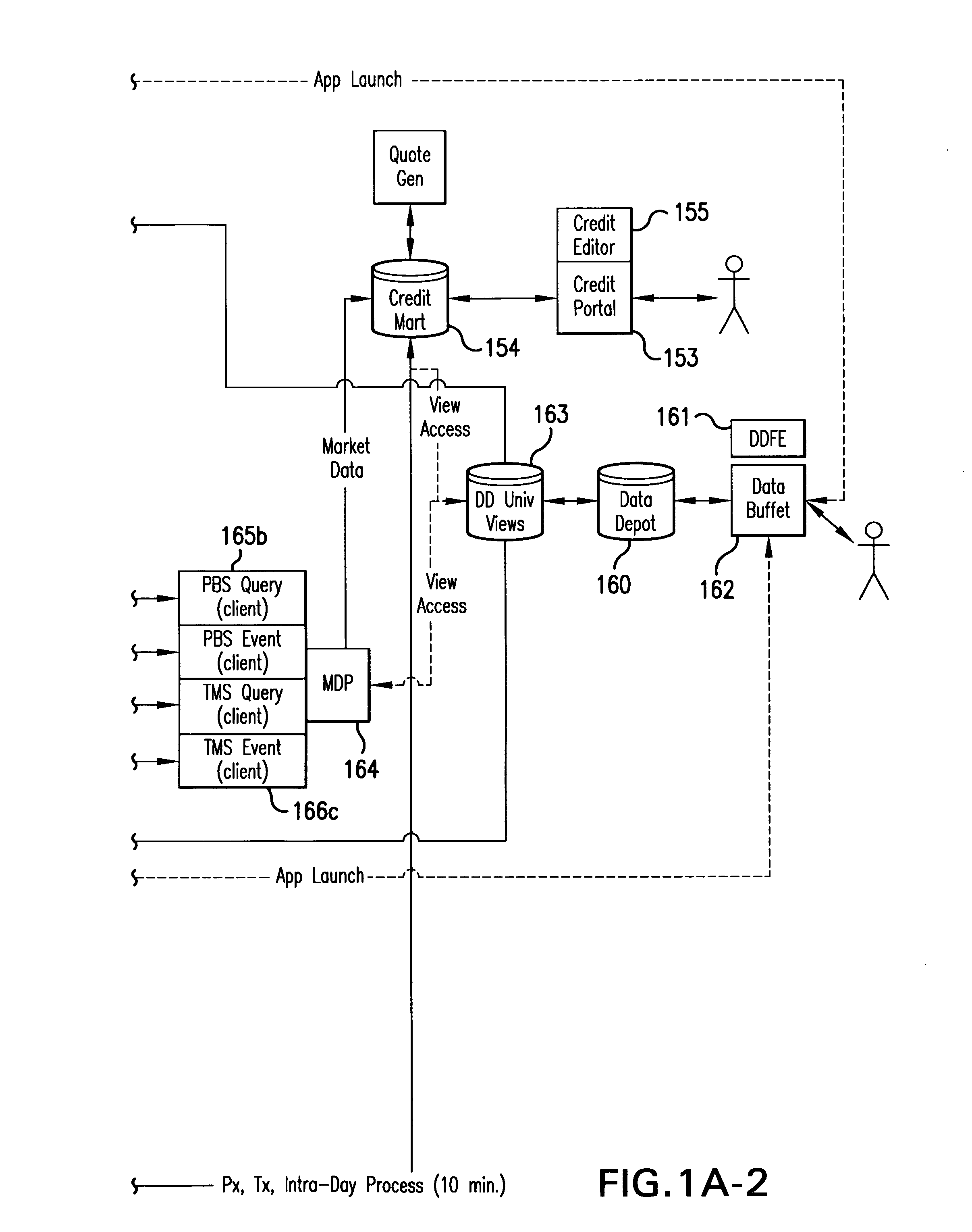

Automated trading system and software for financial markets

InactiveUS20050283427A1FinanceSpecial data processing applicationsTransaction managementFinancial transaction

A redundant and hosted automated trading system and software for financial markets which allows price speculators to create fully automated or partially automated trading systems or engines using technical and fundamental data-driven triggers for market entry, exit, and trade management is provided. The automated trading system can reside locally on the user's computer or reside and is actuated in a remote, hosted, redundant computing environment. The system allows the trader to create fully or partially automated simple or complex conditions for market entry, market exit, and in-trade management which are then executed by the automated system on behalf of the trader. The system also enables users to automate their in-trade decisions through use of contextual exits which allow users to optimize each trade by mapping different strategies for each level. The system also enables users to create, manage, buy, sell, license, or provide automated trading processes, signals, or engines including selling automated signals or engines to other users for financial gain.

Owner:FX ENGINES

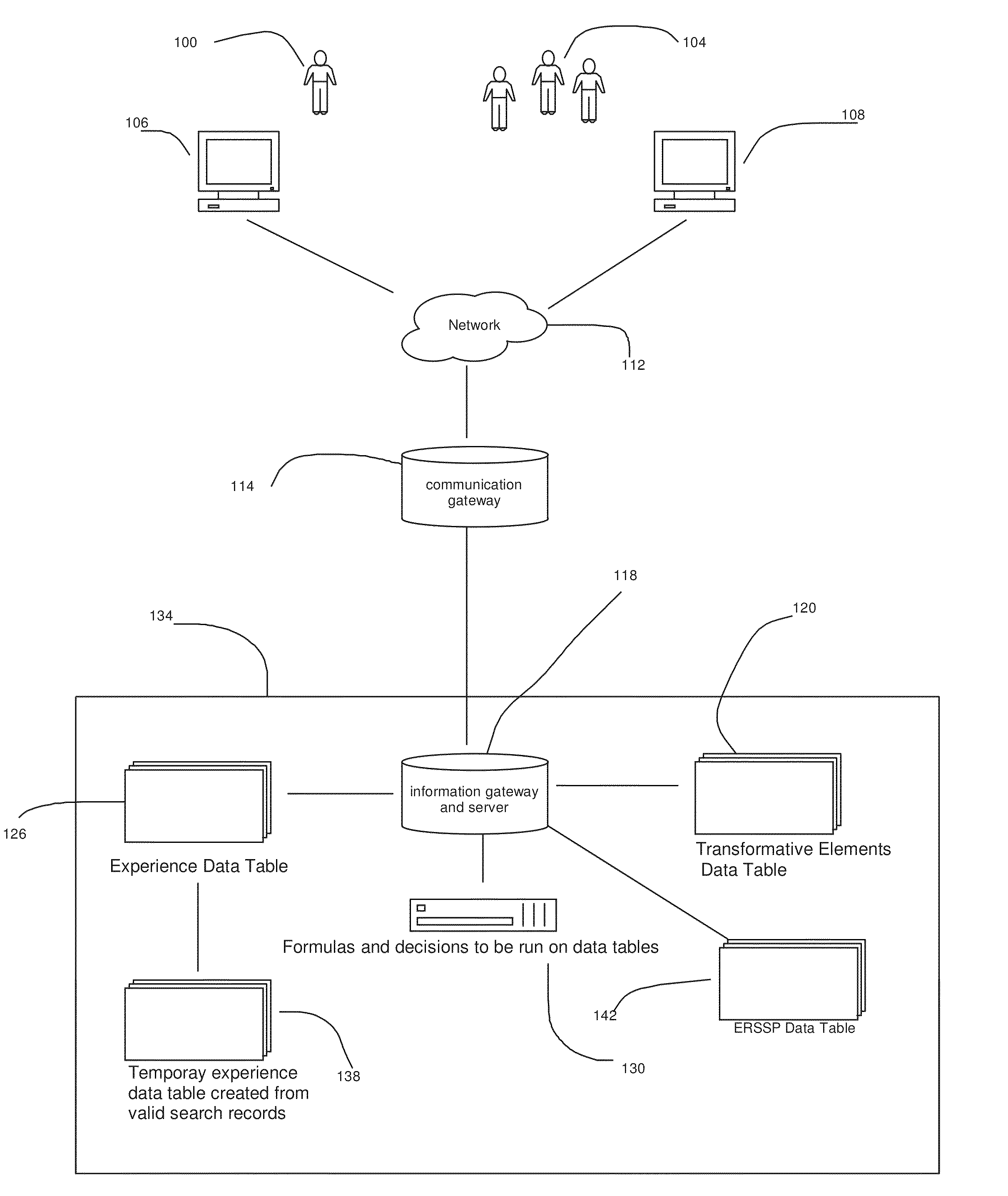

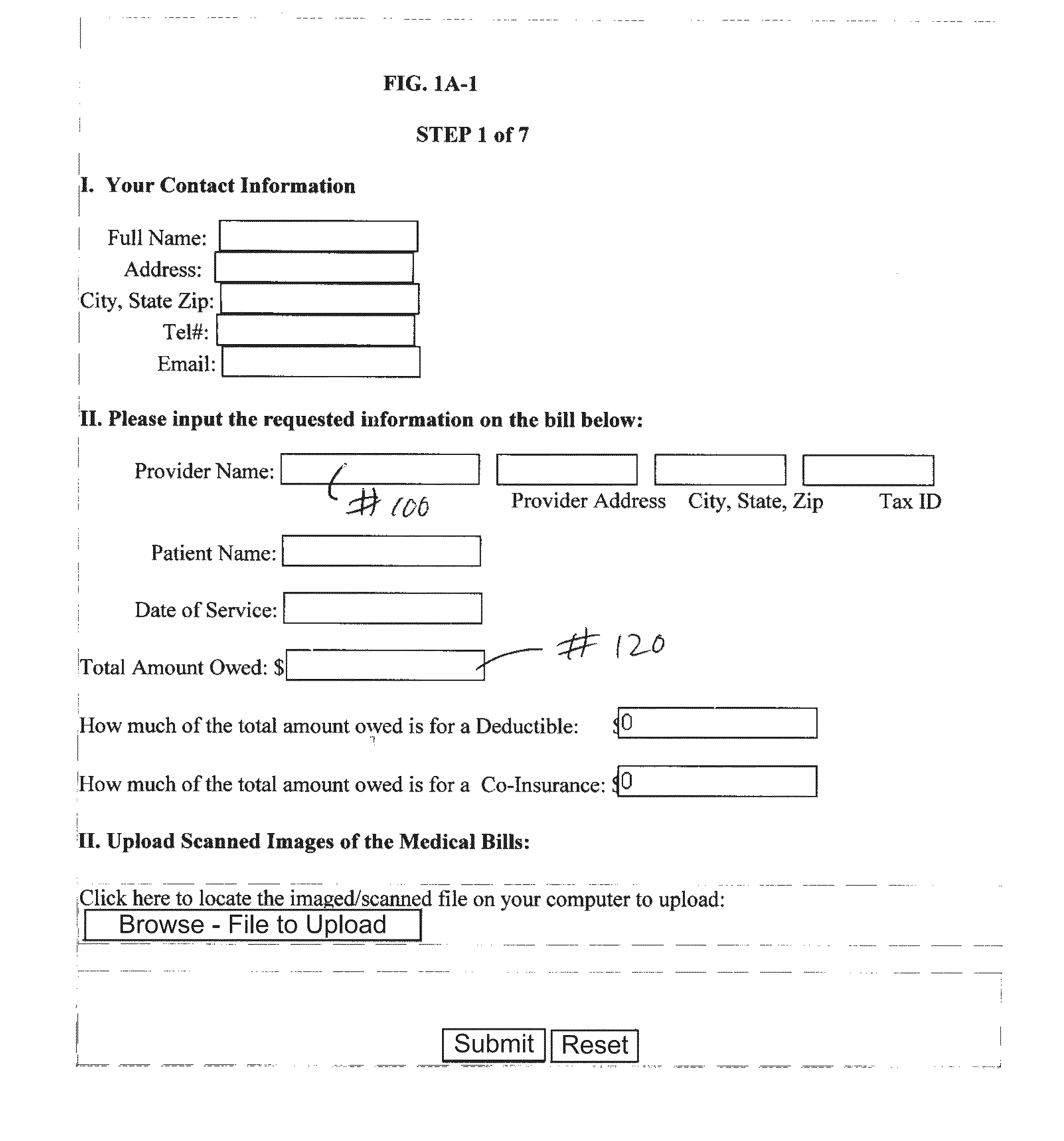

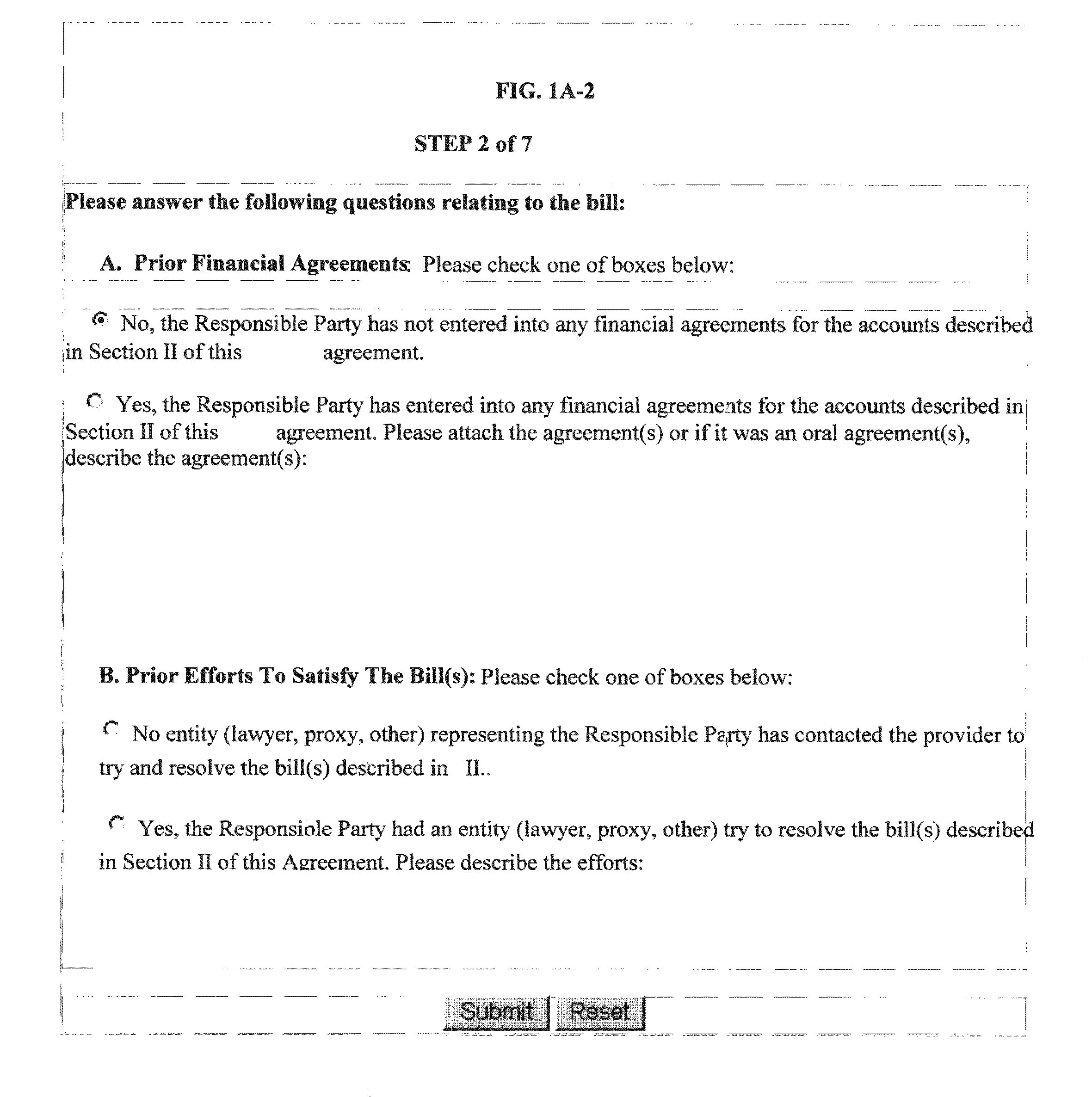

System and method to profit by purchasing unsecured debt and negotiating reduction in amount due

A purchase of debt system (“PODS”) and process that allows a debtor and entity using the system to financially benefit by exploiting the errors, fraud and inefficiencies contained in debts, such as medical bills. Specifically, the type of debt associated with, for example, medical bills is debt liability that has no asset(s) associated with it. The debtor is benefited by assigning the debt and associated liability, at a reduced price, to a third party (the entity using the system). The entity using the system then obtains a financial benefit by settling the debt, with the creditor, for an amount less than that paid to it by the debtor.

Owner:FLYNN KEVIN

Real estate derivative financial products, index design, trading methods, and supporting computer systems

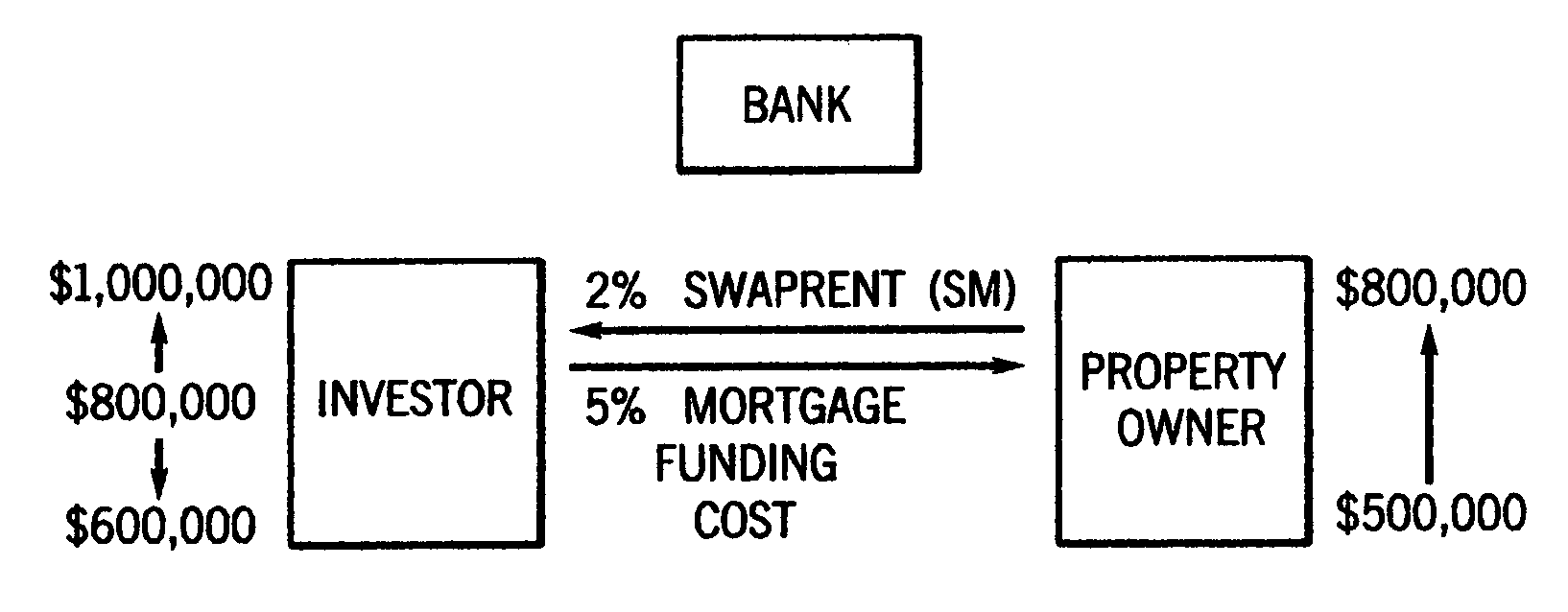

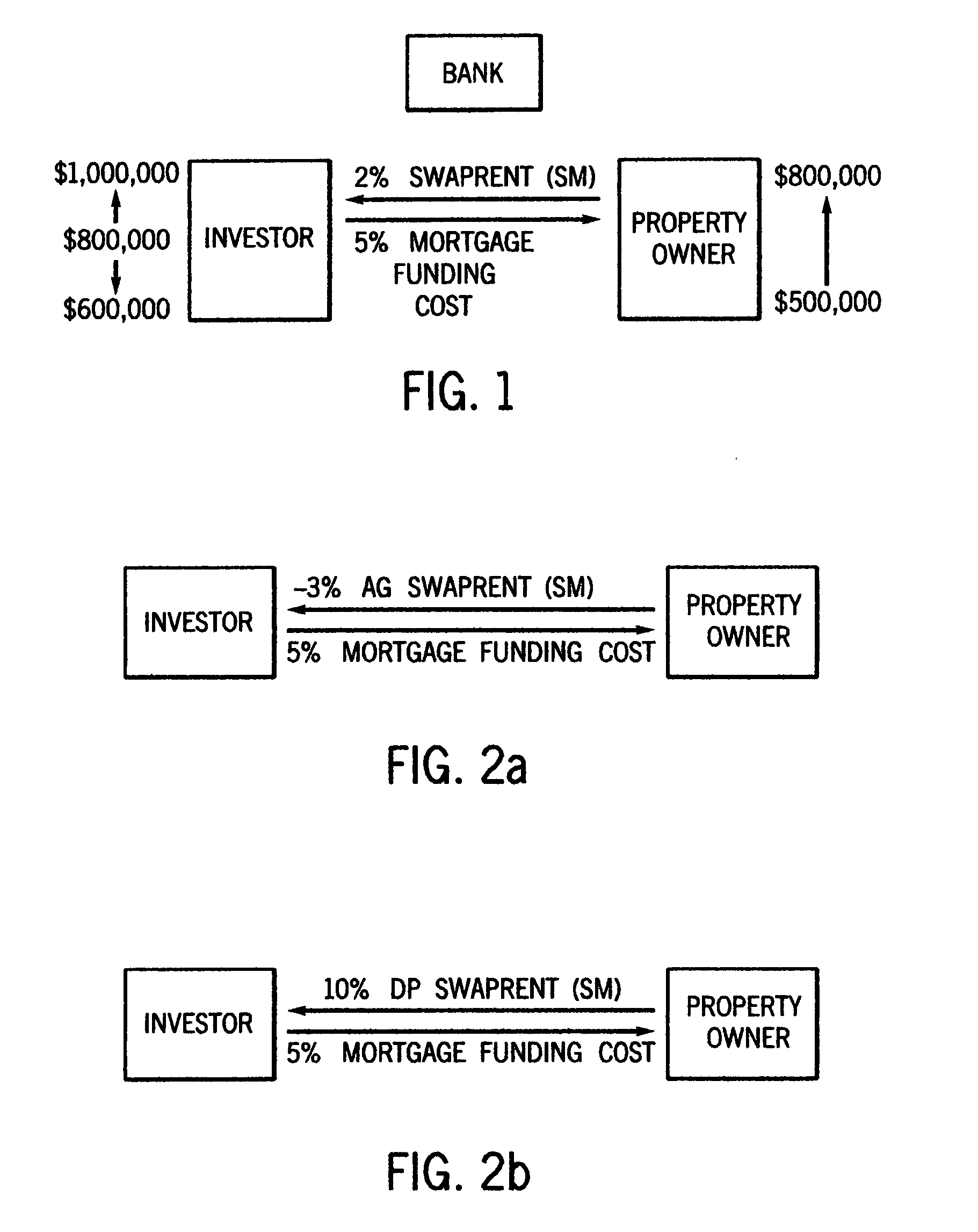

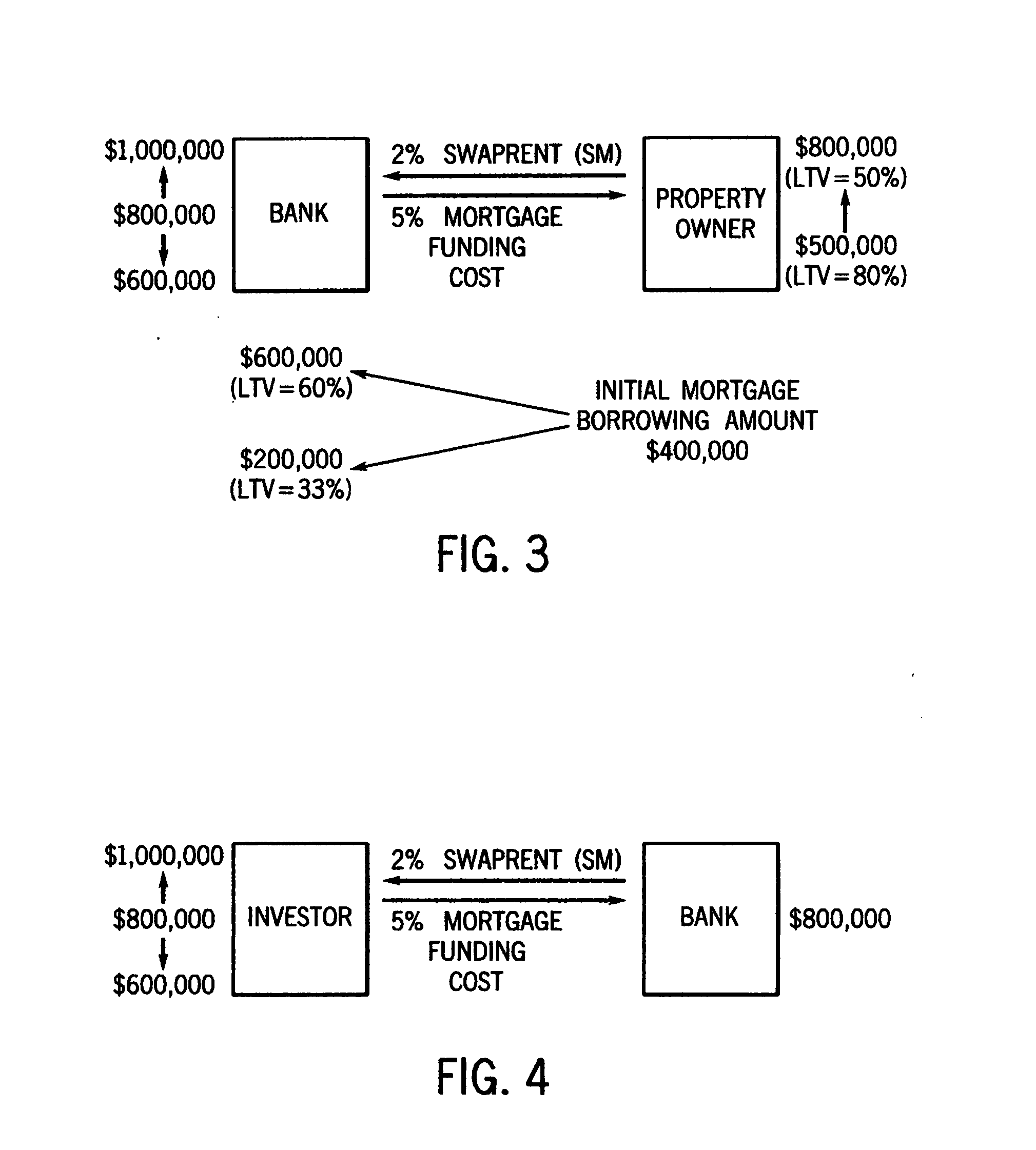

In accordance with the principles of the present invention, real estate derivative financial products, index design, trading methods, and supporting computer systems are provided for property owners and investors to temporarily swap their respective economic interests in owning / disowning an underlying property for a certain period of time, directly or through some middlemen. Therefore in addition to the traditional ways of either buying / selling or renting property, the property owner could consider a third new way of dealing with a property. The present invention provides a very straightforward way to enable property owners to protect the gains or prevent further losses in their property equity value. On another hand, the present invention also allows investors to establish an exposure in a potential property equity appreciation or depreciation in a particular neighborhood.

Owner:LIU RALPH Y

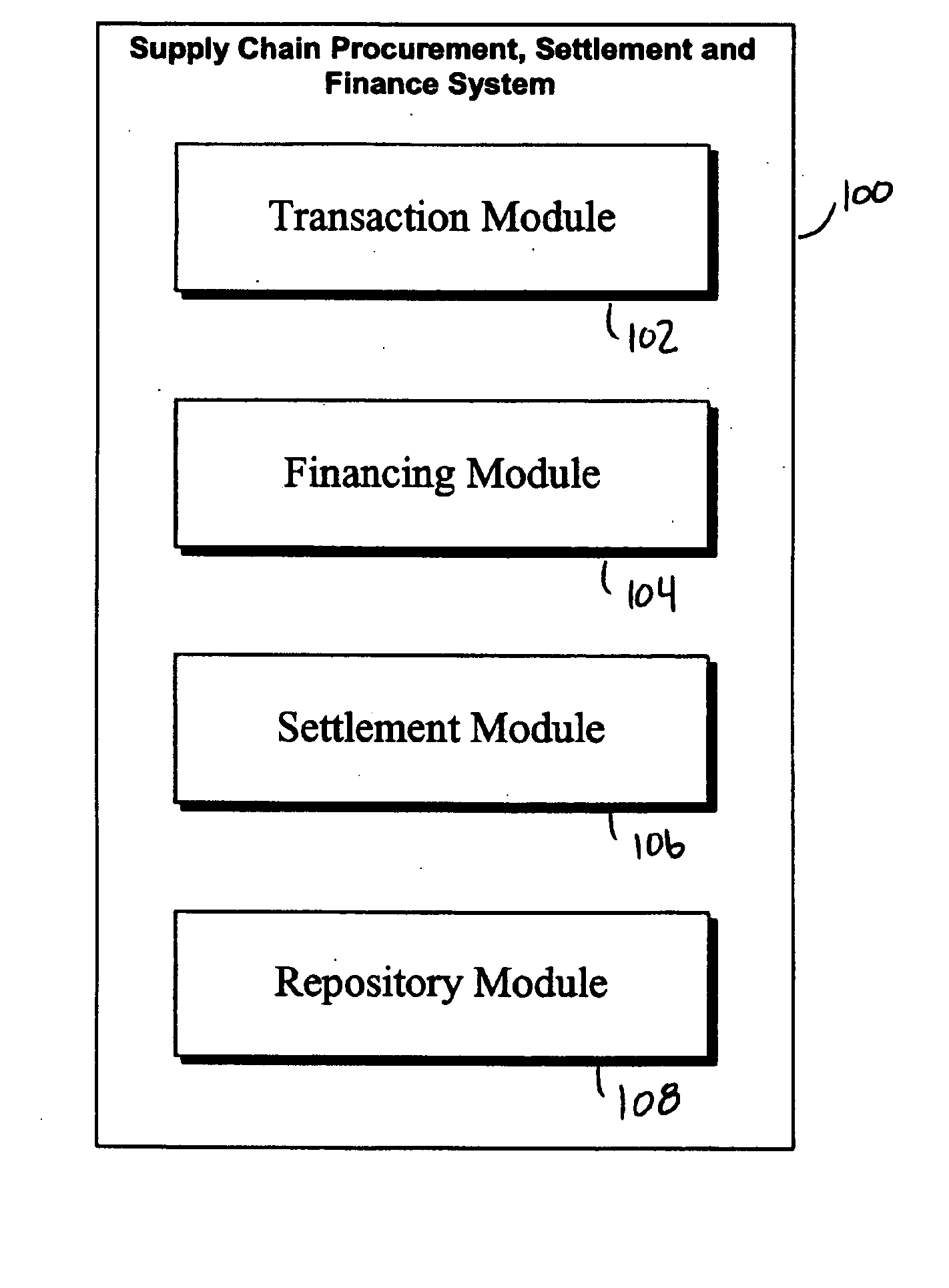

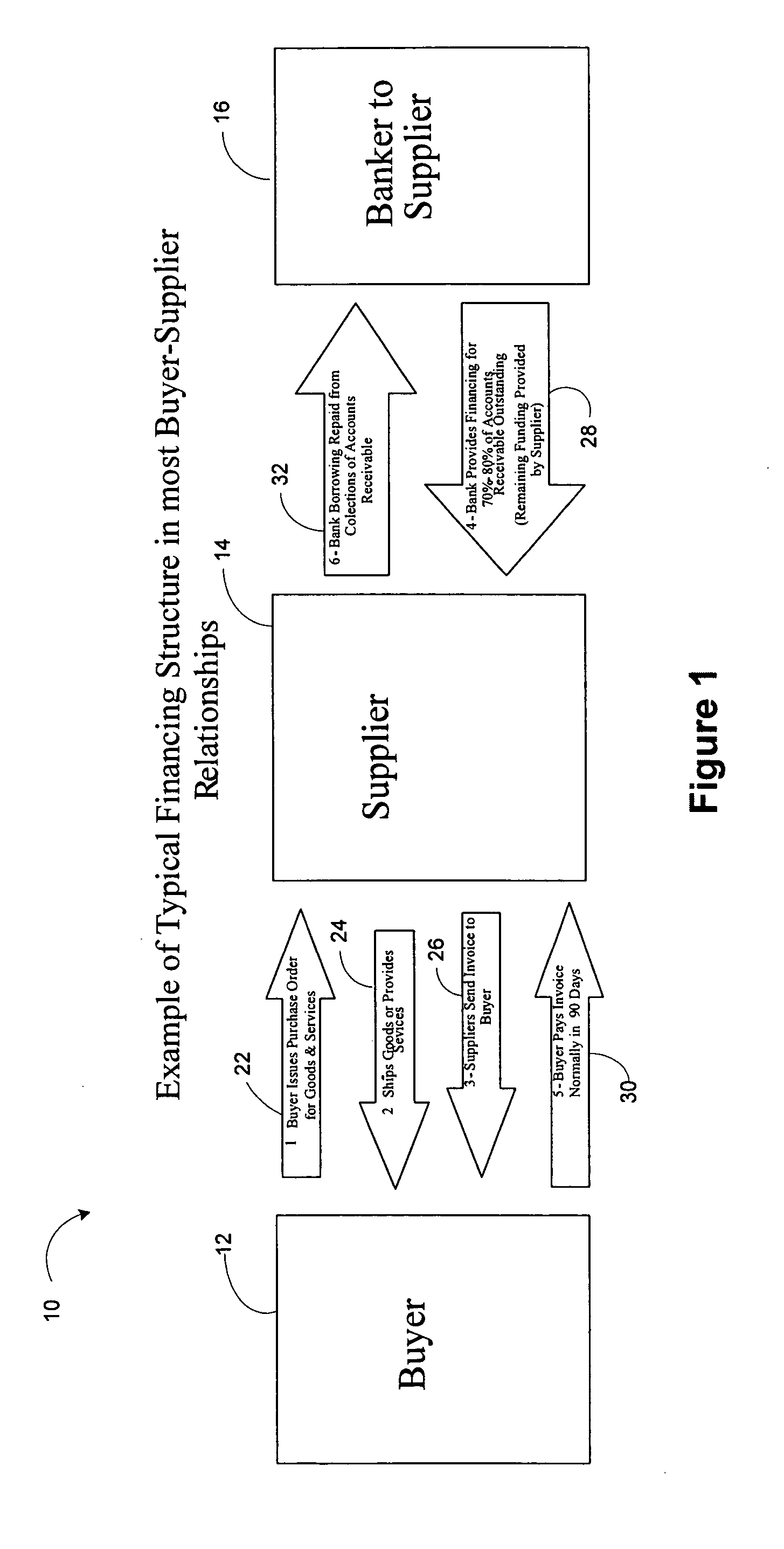

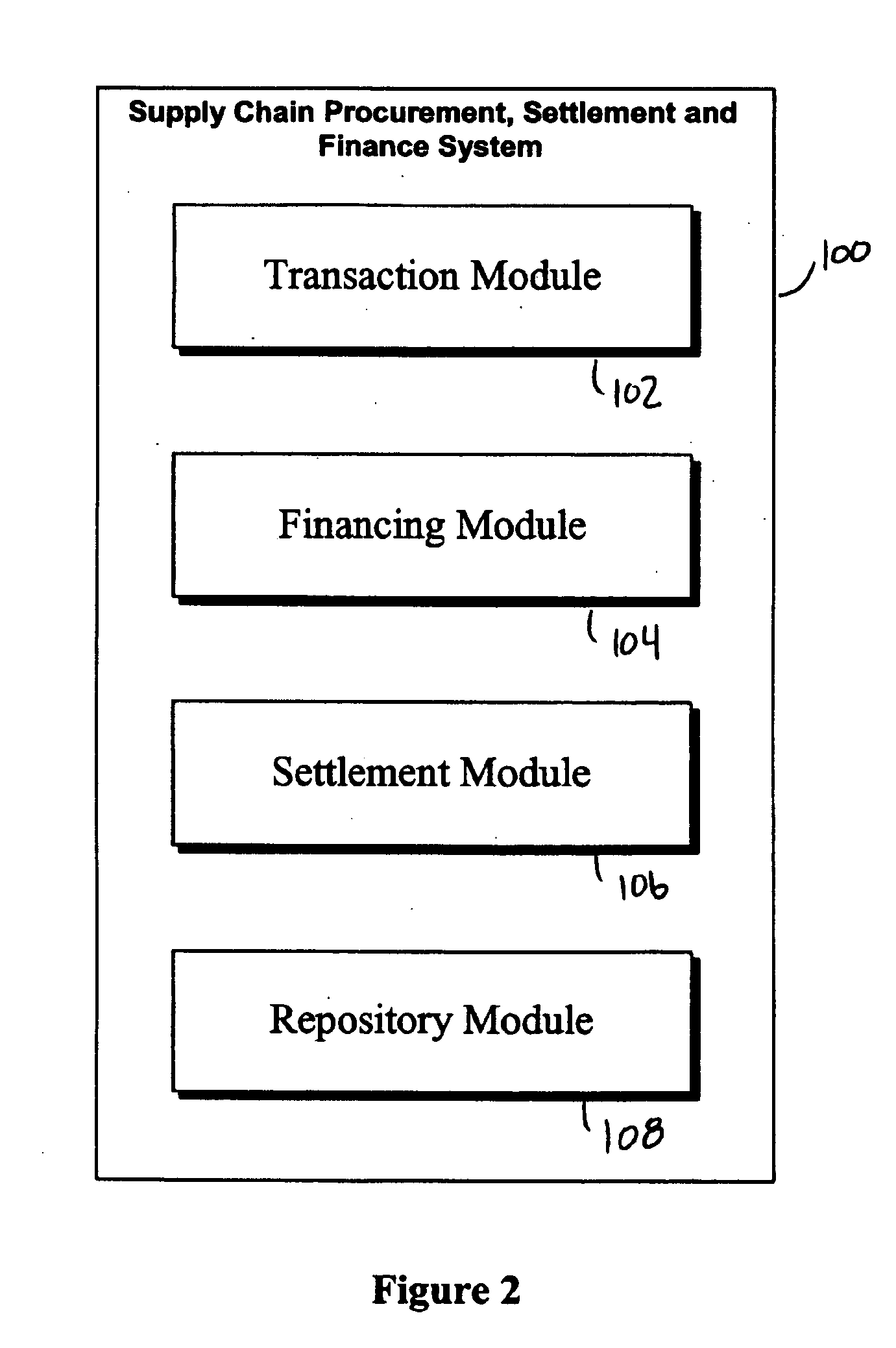

System and method of supply chain procurement, settlement and finance

InactiveUS20060095367A1Reduce processReducing administrativeFinancePayment architectureLogistics managementService provision

A supply chain procurement, settlement and finance system and method of providing procurement and settlement logistics for buyers and financing for suppliers is provided. The system comprises a transaction module for purchasing and receiving goods and services from a supplier, a finance module for providing a financial interest for the goods and services, a settlement module for determining and settling supplier and non-supplier obligations, and a repository for storing buyer data and administration data of the transaction module, finance module and settlement module. The method comprises the steps of issuing to a supplier a purchase order for goods and services, providing a financial interest to the goods and services, computing the amount owing to a supplier when an invoice is not used as the primary document to determine a liability to a supplier, processing invoices and tabulating liabilities owing to suppliers, paying the supplier, selling and collecting proceeds from the sale of goods and services sold to customers and consumers of buyer, and retiring the financial interest to the goods and services.

Owner:PARADOX FINANCIAL SOLUTIONS

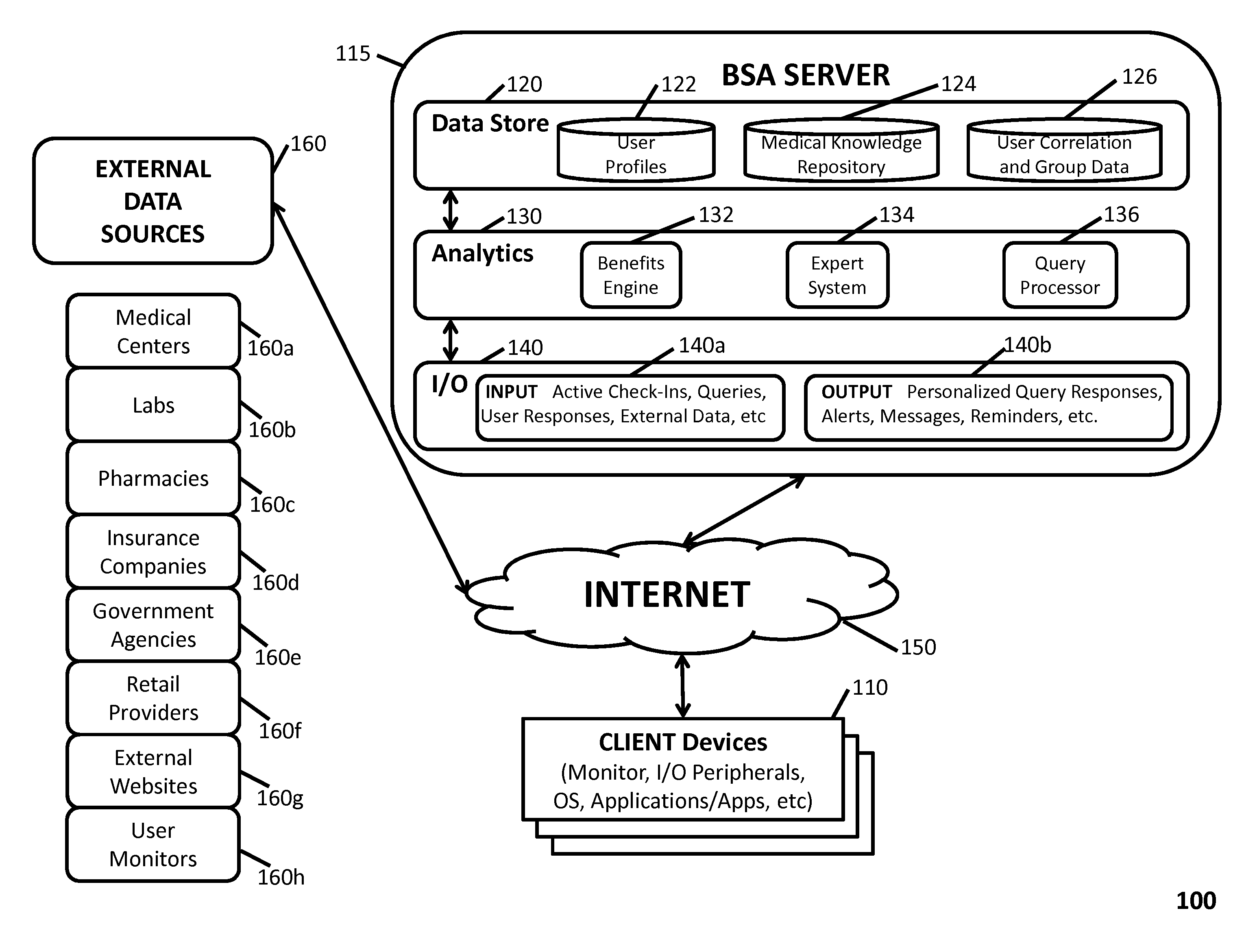

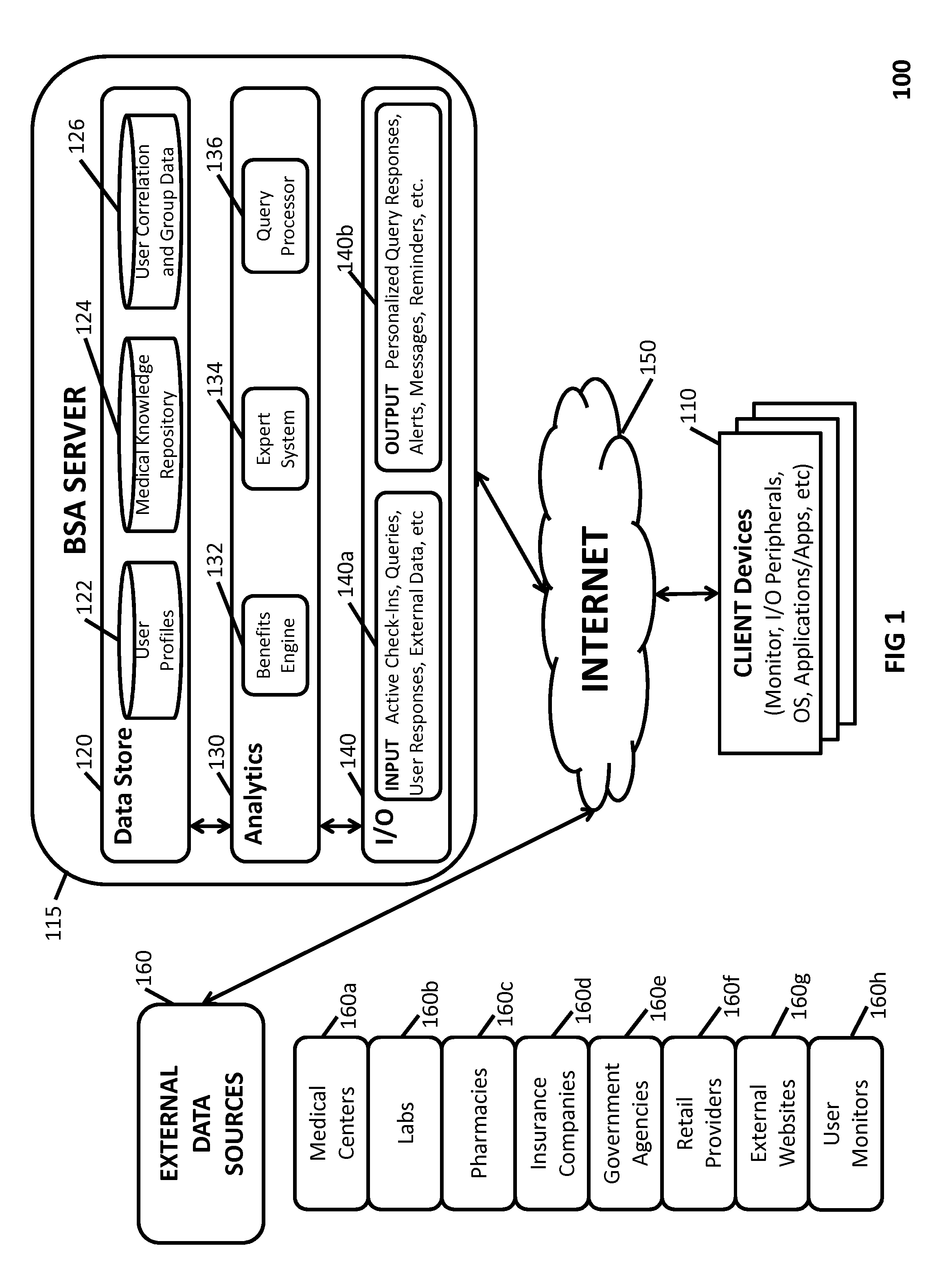

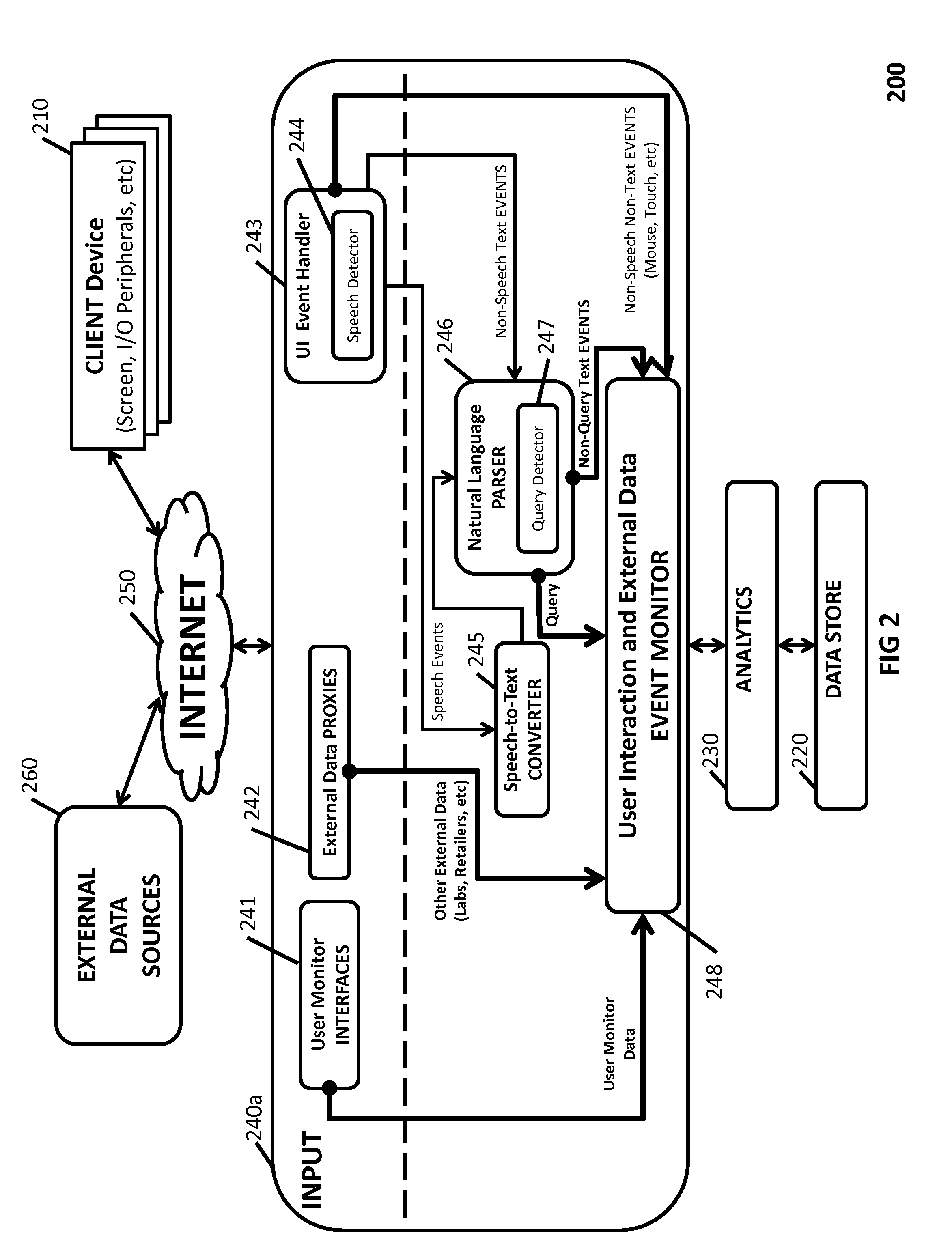

Facilitating Integrated Behavioral Support Through Personalized Adaptive Data Collection

ActiveUS20160012194A1Easy to processEnhance their wellnessPhysical therapies and activitiesMechanical/radiation/invasive therapiesPersonalizationEconomic benefits

The present invention includes various embodiments of a BSA system that facilitates the collection of relevant health-related data on a continuous basis, integrates such data with pertinent personal and aggregate information, enables users to purchase (directly and indirectly) health-related goods and services, and provides credit, discounts and other economic benefits in connection with such purchases that are determined dynamically based upon the nature and extent of users' interaction with the system. The BSA system facilitates a dynamic feedback process by continually monitoring user interaction and medical and financial behavior, which results in dynamic adjustments to their credit levels and offers of discounts and other promotions, which in turn incentivizes users to continue participating in the process (thereby modifying their system interactions and behavior, and thus perpetuating this feedback loop). As a result, users are incentivized to actively participate in the process and thereby enhance their wellness while reducing healthcare costs.

Owner:PRAKASH ADITYO +1

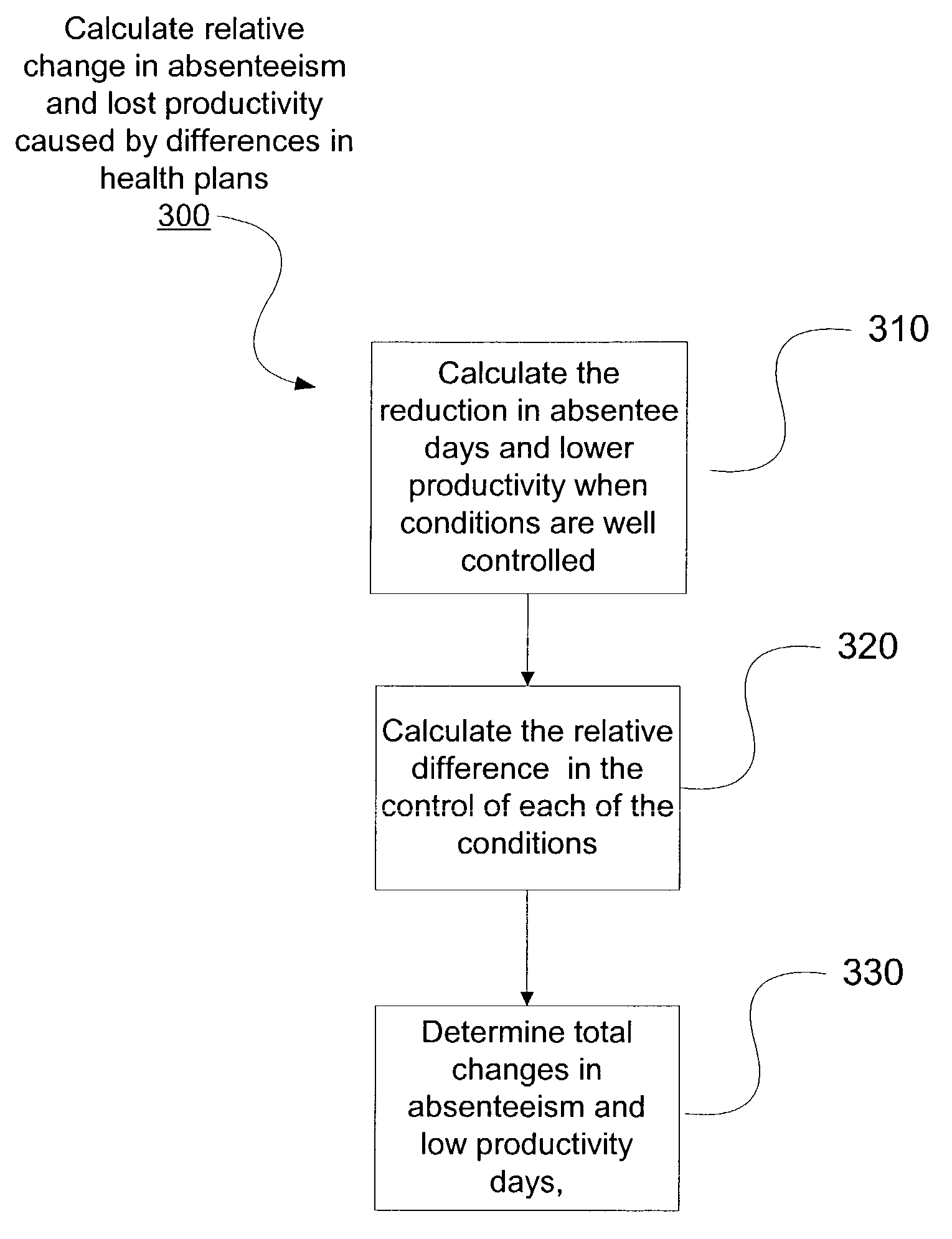

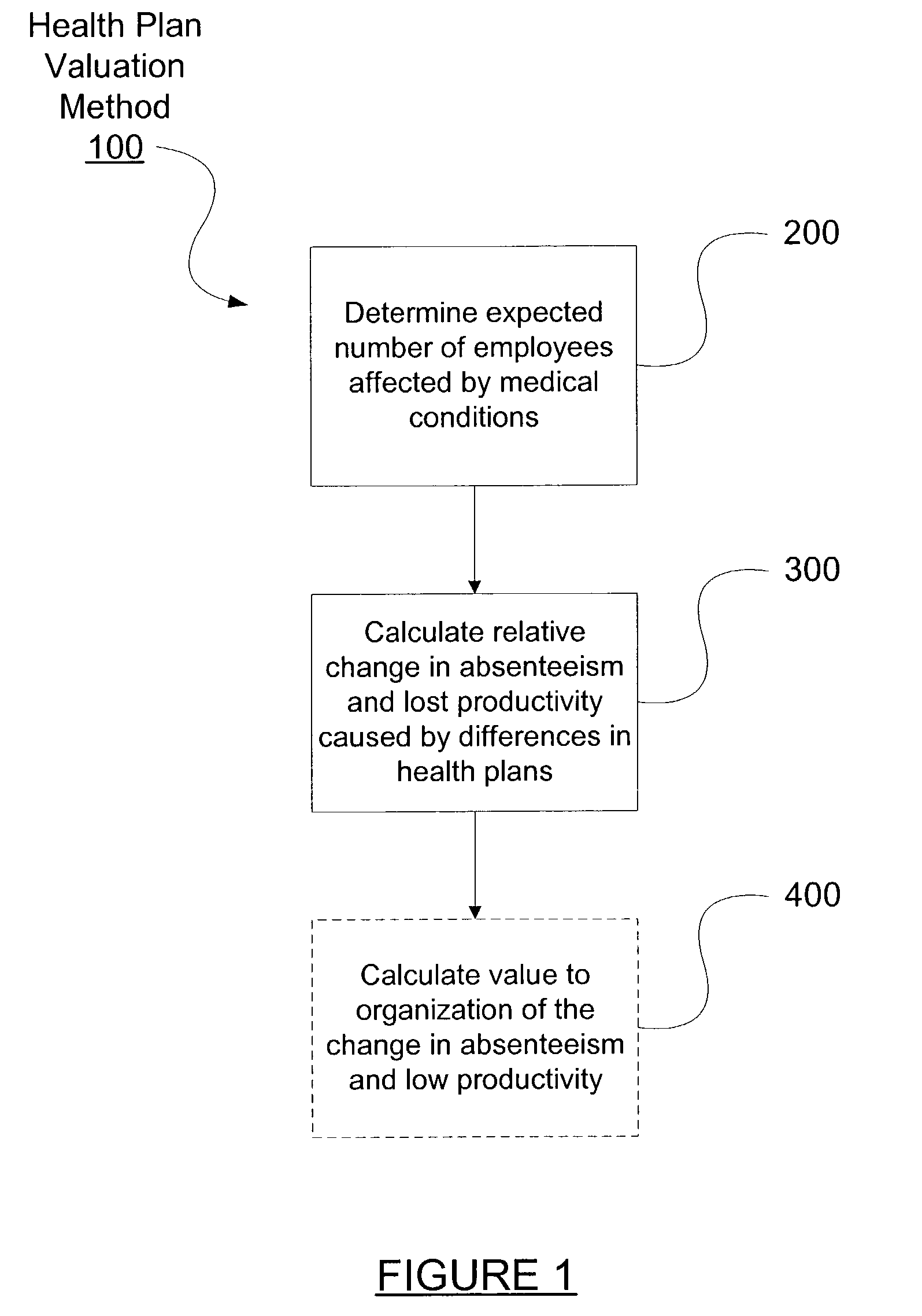

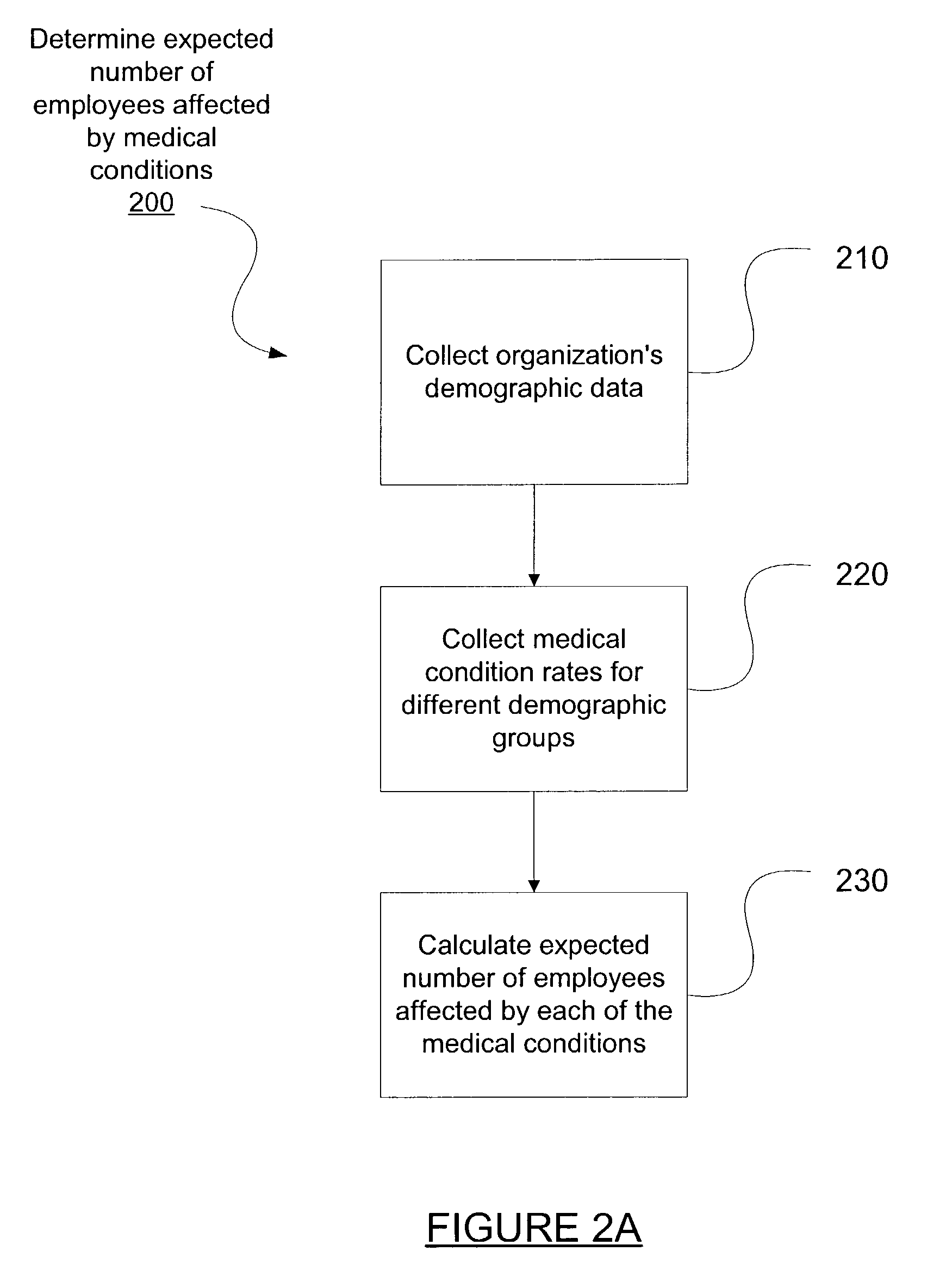

Economic model for measuring the cost and value of a particular health insurance plan

ActiveUS7624037B2Increase differentiationImprove health careFinanceOffice automationProduction rateEconomic benefits

The present invention provides a system and method for measuring the relative economic benefits from services offered by health care plans. The present invention quantifies value of health care quality by indicating an economic return on the investment in health care quality, enabling organizations and businesses to view health care quality in a familiar paradigm that extends health plan differentiation beyond premium and benefits. Businesses may employ the present invention to compare different health care plans or classes of plans, such as accredited versus non-accredited plans. Specifically, a particular plan or class of plans may provide improved monitoring, treatment and control of various medical conditions, and the present invention quantifies the economic benefits to employers from the improved health care for employees. In one embodiment, the present invention looks to a set of specific medical conditions and is based on three key steps. First, the present invention identifies the overall level of employees at the organization affected by these conditions. Second, the present invention uses the reduction in absenteeism and low productivity days made possible by improved monitoring and control of the medical conditions. Third, the present invention calculates a monetary valuation to the firm of the reduction in absenteeism and low productivity days based on the firm's average revenue per employee, average daily wage, and other parameters.

Owner:NCQA

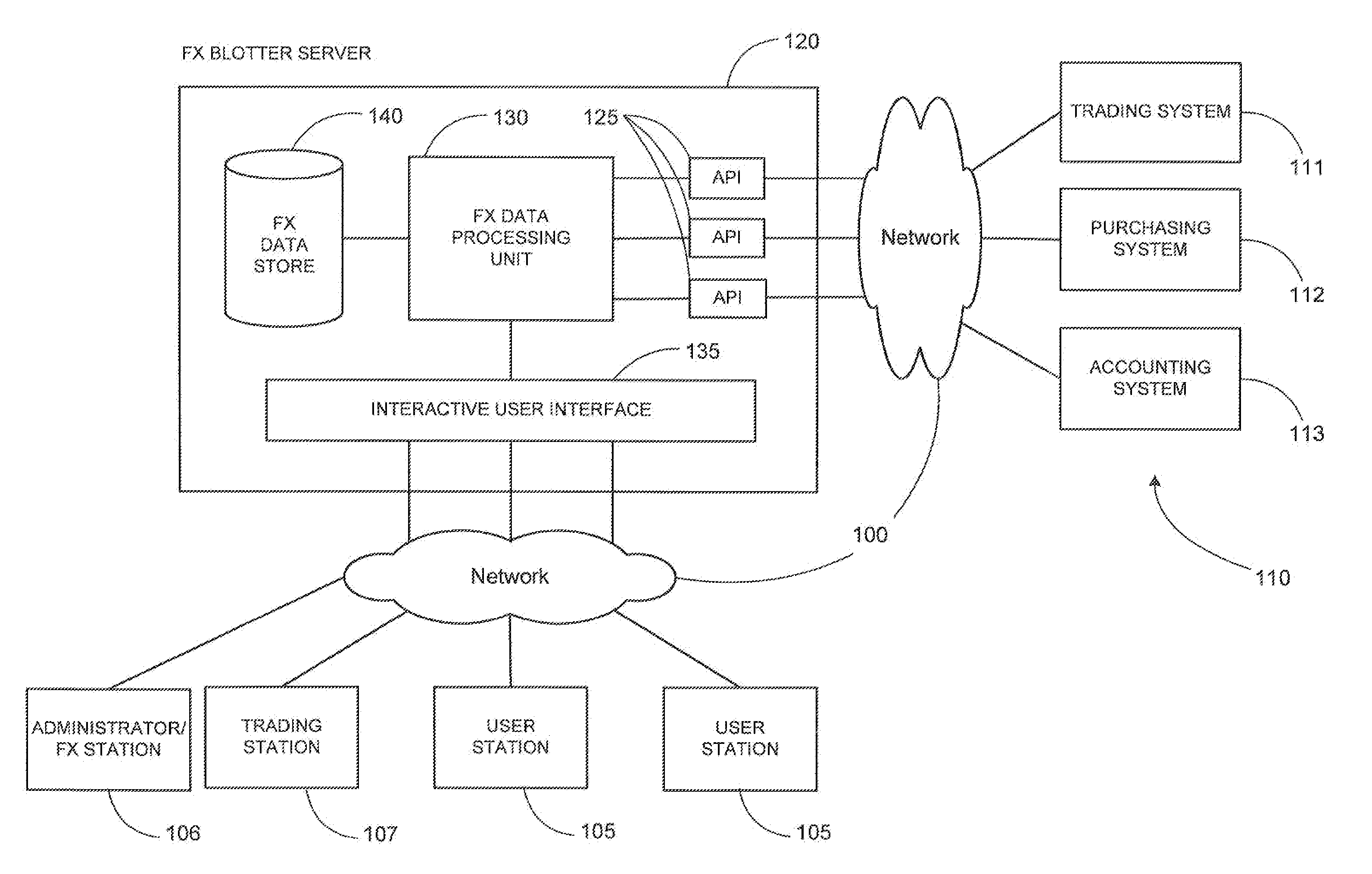

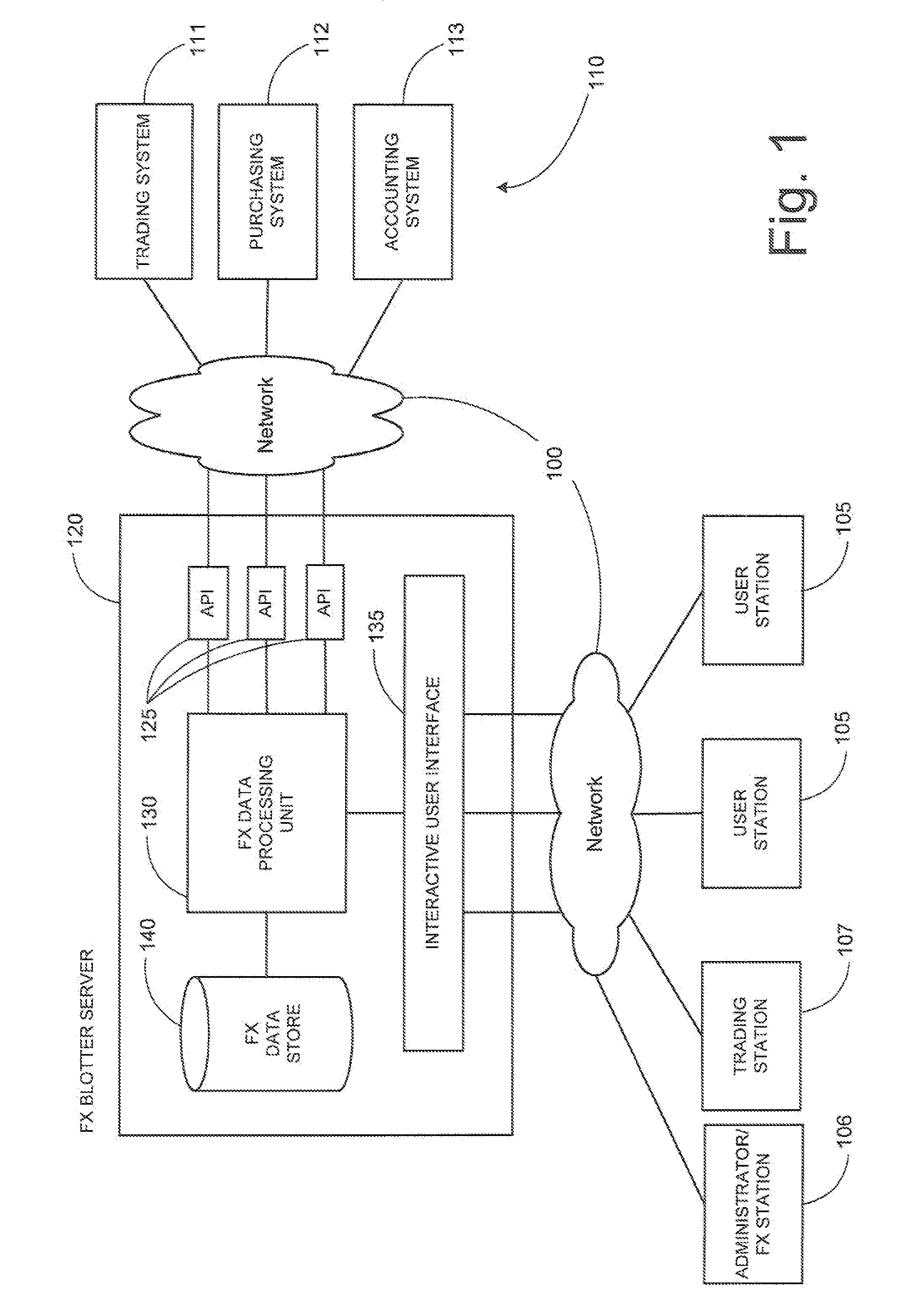

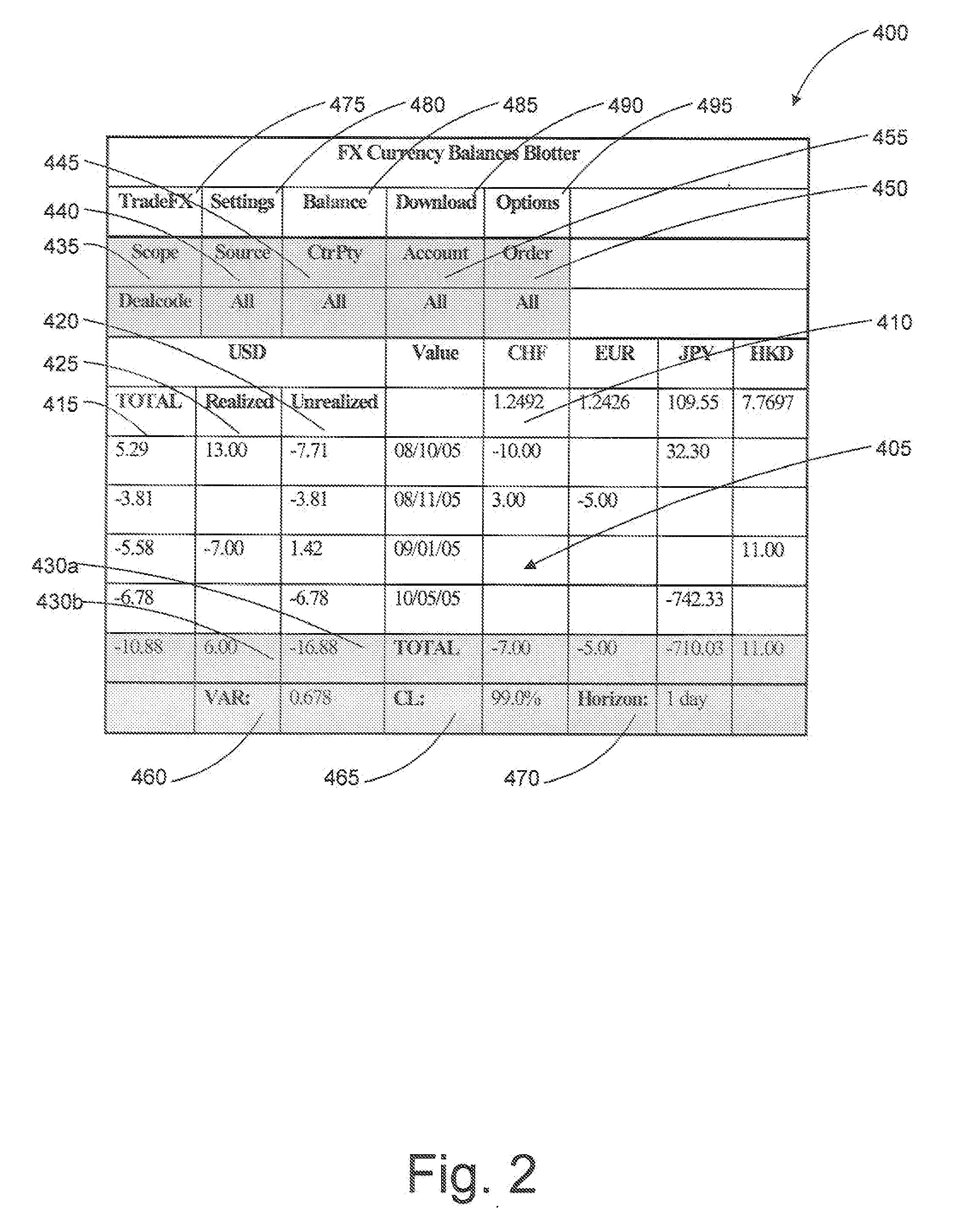

System and method for facilitating foreign currency management

ActiveUS20080027850A1Easy to manageReal time monitoringComplete banking machinesFinanceFinancial transactionOnline trading

Systems, methods, and computer program products for facilitating managing foreign currency exposure, such as that with respect to transactions in financial interests involving foreign currency exchange across multiple electronic trading platforms, financial systems, accounting systems or the like. Users may monitor their net foreign exchange (“FX”) exposure in different currencies and on different value dates due to trading in foreign exchange, foreign currency-denominated equities, fixed-income securities, commodities, services, goods and other transactions involving foreign currency exchange. Various tools may be provided for monitoring and managing FX exposures across multiple trading platforms through ready access to FX liquidity sources as well as for conducting financial transactions involving foreign currency exchange, such as FX hedging or other types of transactions.

Owner:BLOOMBER FINANCE LP

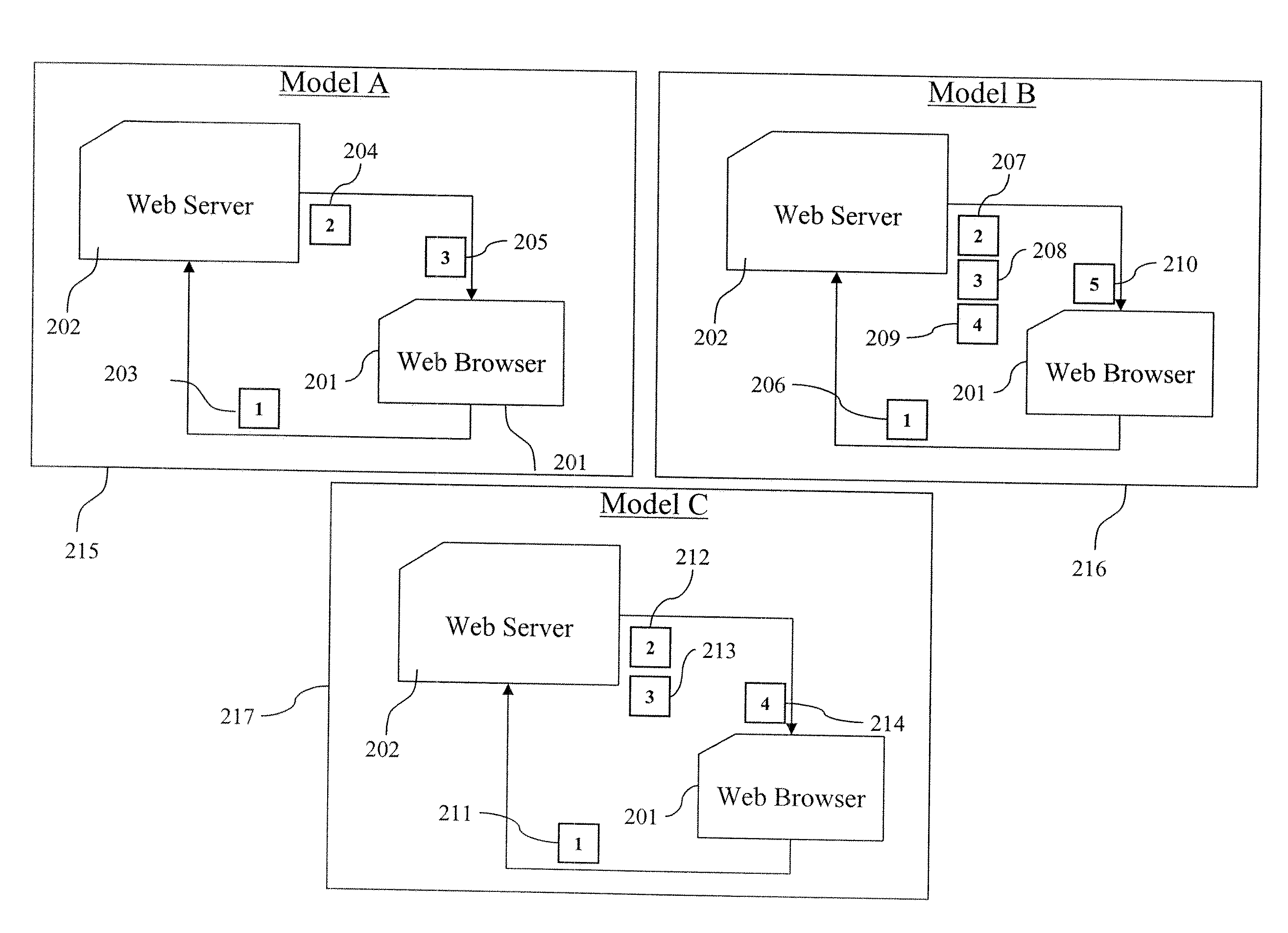

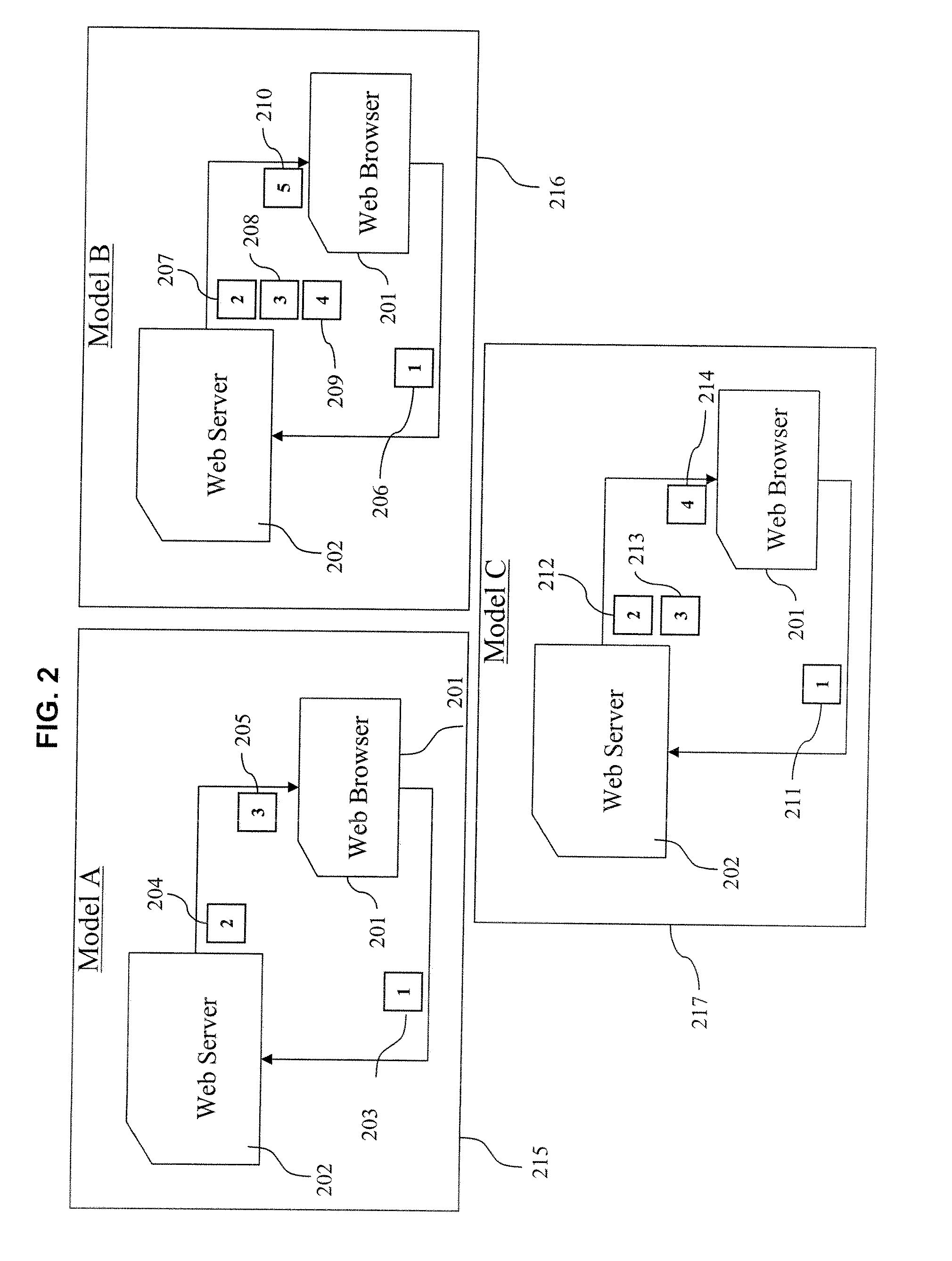

Methods and systems for providing a mini-webpage within a webpage

InactiveUS20100095220A1Easy to controlFacilitate ISP'sInput/output for user-computer interactionWebsite content managementThird partyEconomic benefits

Methods and systems to enable an Intermediate Network Entity (INE) to modify a Web Page requested by an end-user. The modification may involve placing a Mini-Webpage designated areas of the requested Web Page. An INE may be enabled to receive a request for a Web Page, process the request, modify the requested Web Page by placing Mini-Webpages in designated areas of the Web Page. The methods would allow the Mini-Webpages to be formed by the INE, Web Page provider or a third party ad server. The Mini-Webpages may be targeted based on certain criteria such as the nature of the Web Page requested, the information about the end-user, and the information about the INE. An INE may share some of the economic benefits associated with the ability to convey desired information to an end-user.

Owner:MOBILAPS LLC

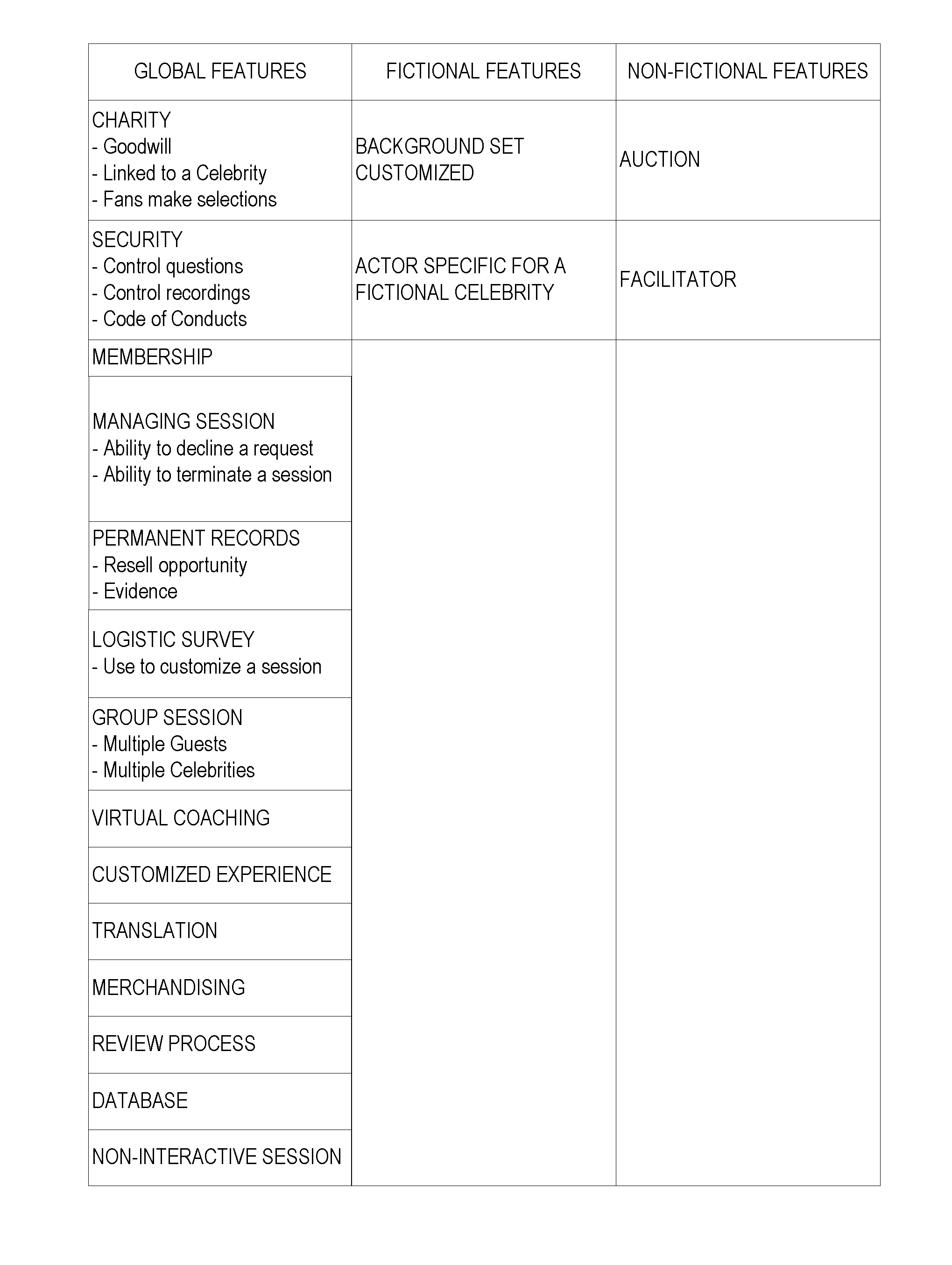

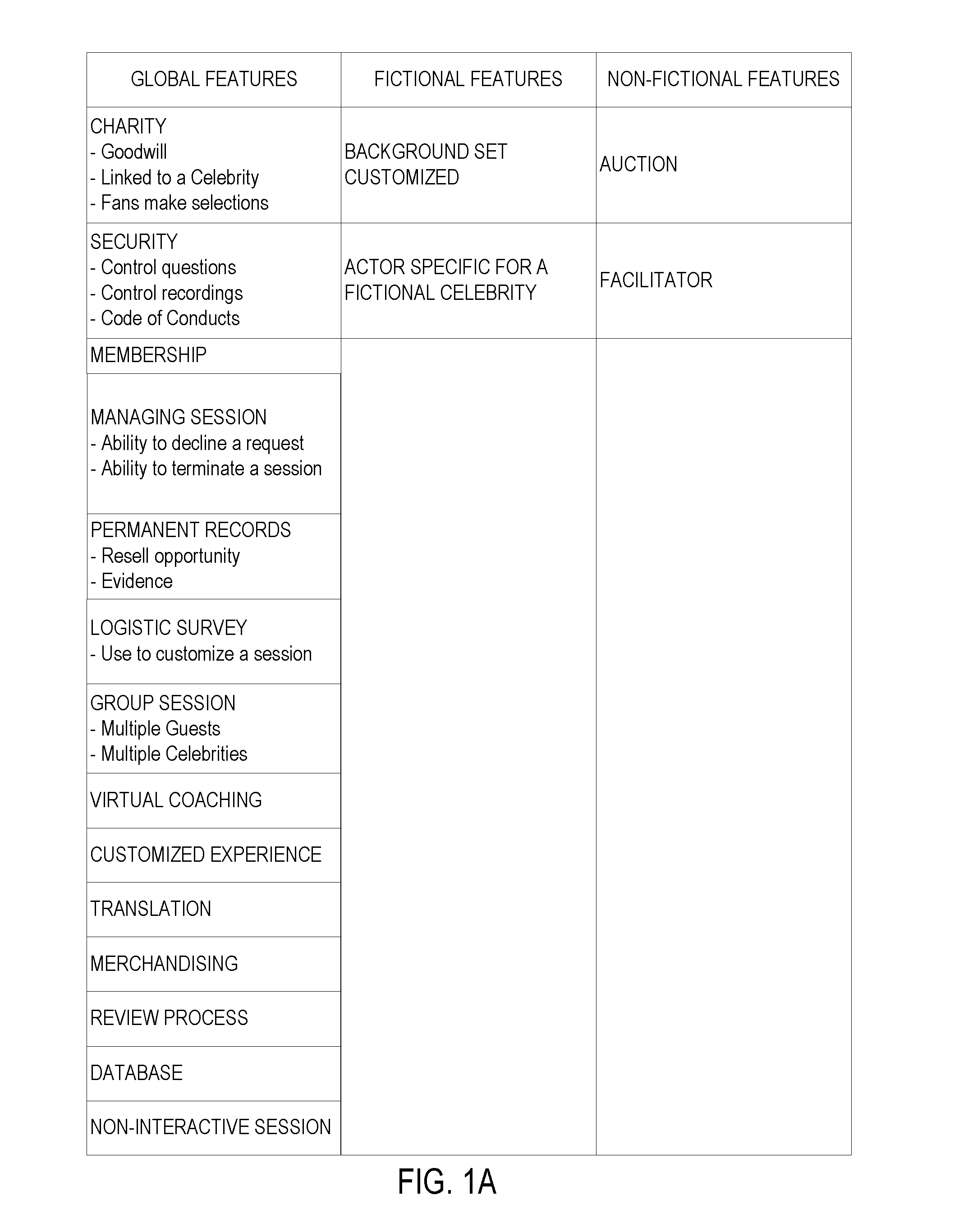

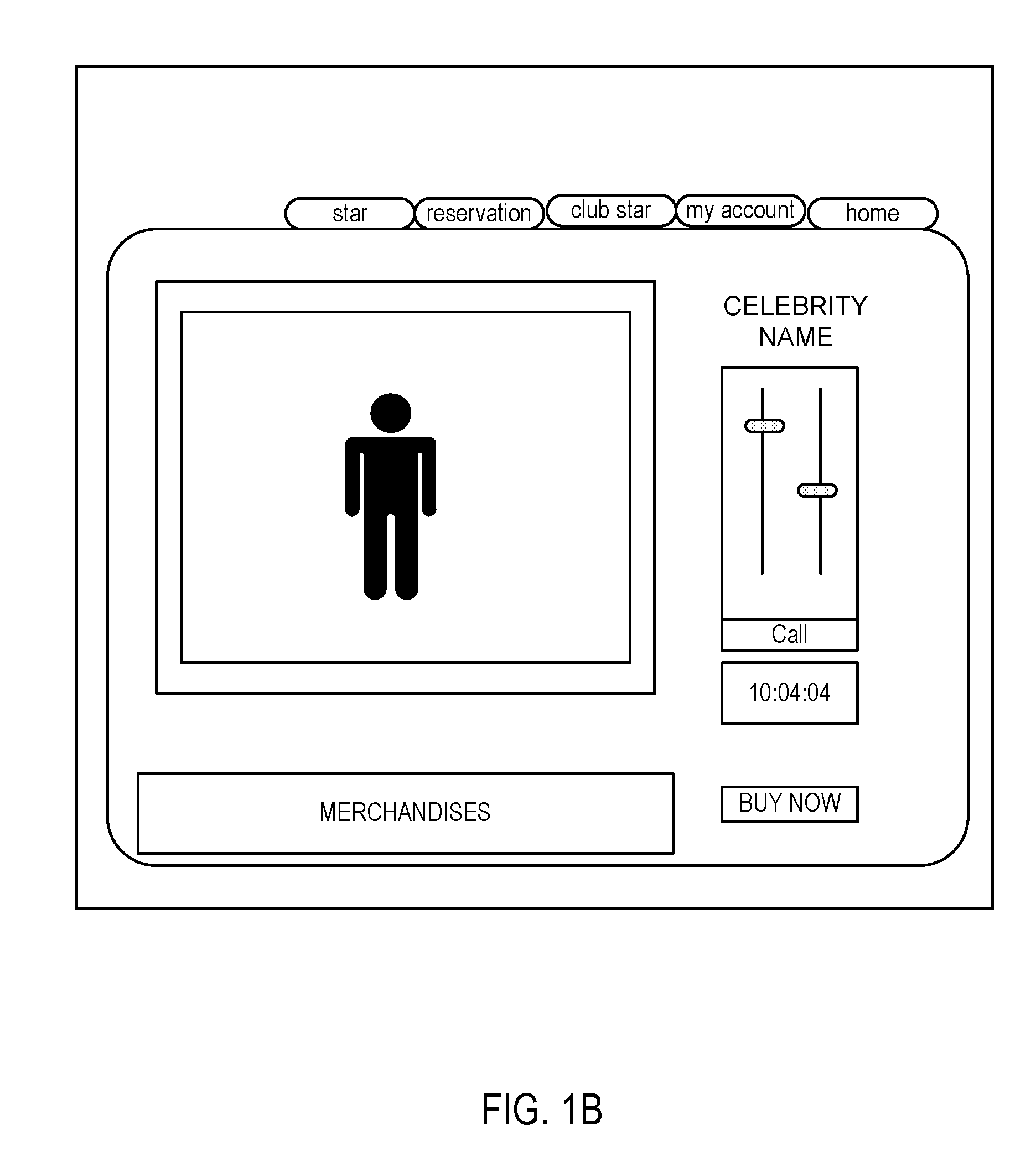

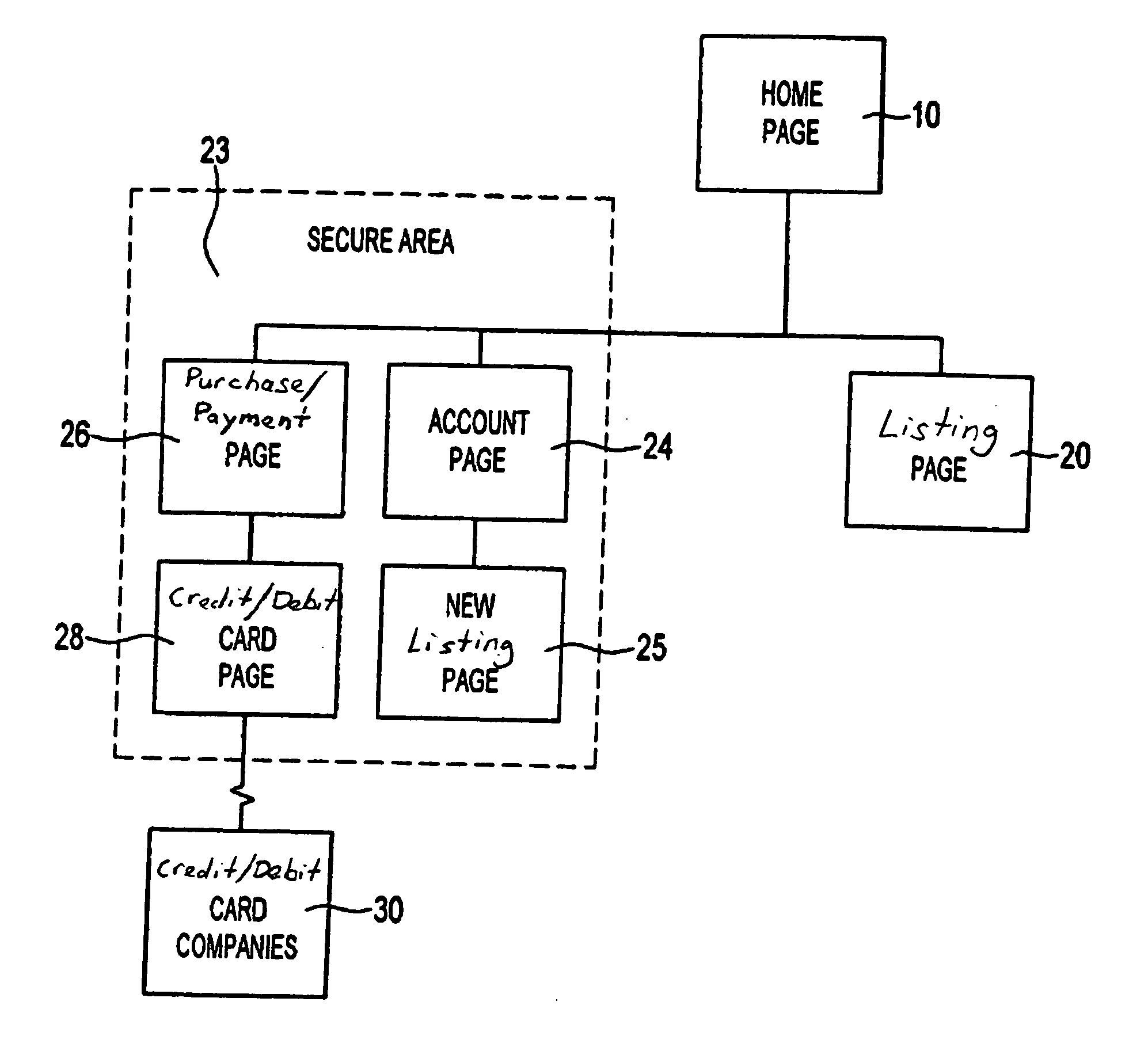

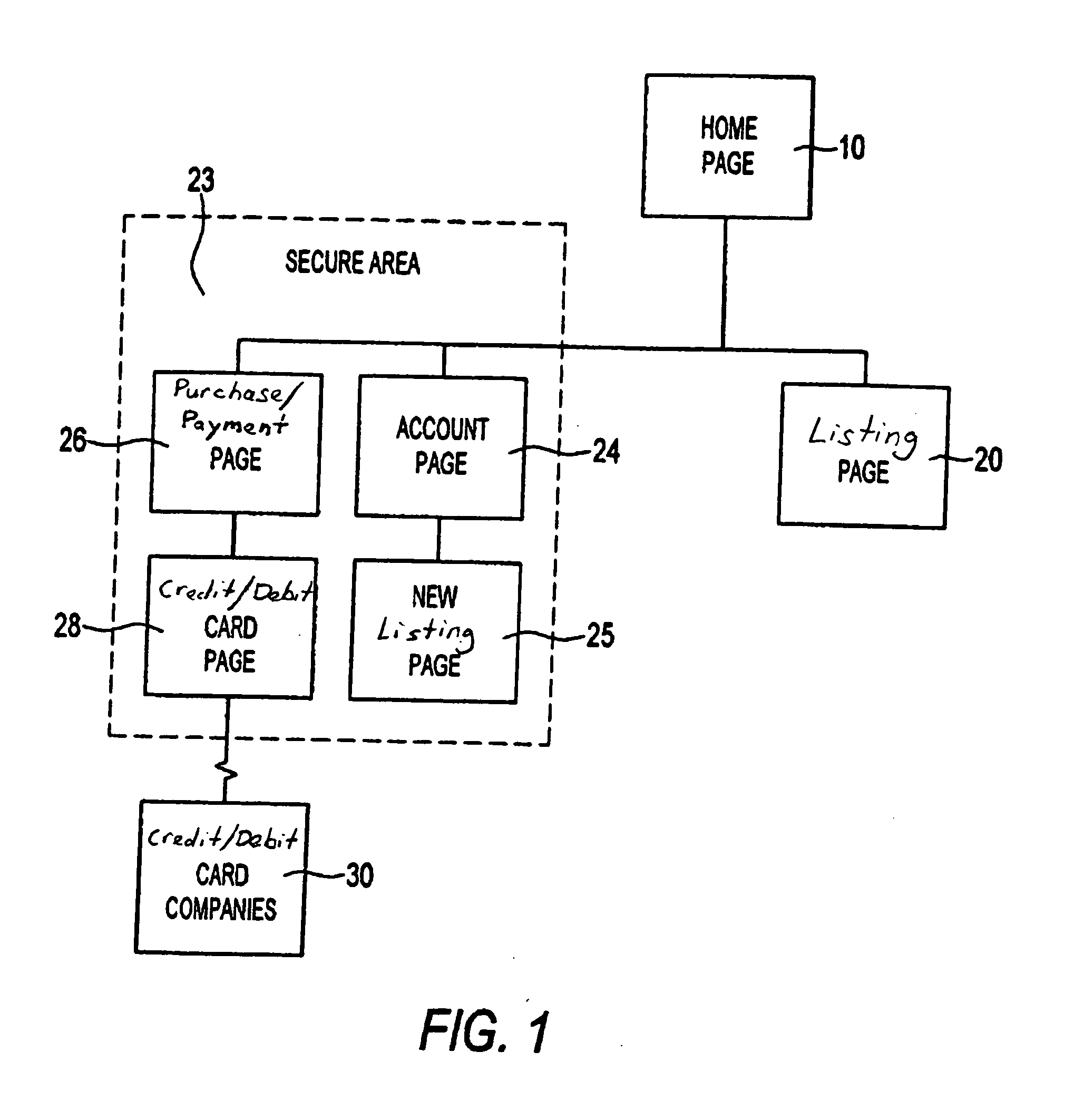

Charitable online interactive system

InactiveUS20070036287A1ReservationsAutomatic call-answering/message-recording/conversation-recordingPaymentInteraction systems

A method for facilitating a charitable guest reservable online celebrity interaction (CGROCI) between a guest and a celebrity via a network is disclosed. The method includes providing guest with information about the charitable nature of the CGROCI. The charitable nature relates to a financial benefit provided to a charity as a result of conducting the CGROCI. The method also includes receiving via the network reservation data, which includes at least a time to conduct the CGROC, from the guest. The method further includes providing an online interactive environment to conduct the CGROCI between guest and celebrity, whereby the celebrity is geographically remote from the guest but interacting with the guest via the online interactive environment. The method yet also includes processing payment from the guest, whereby at least a portion is provided to the charity and another portion is provided to the celebrity.

Owner:FAME INTERACTIVE

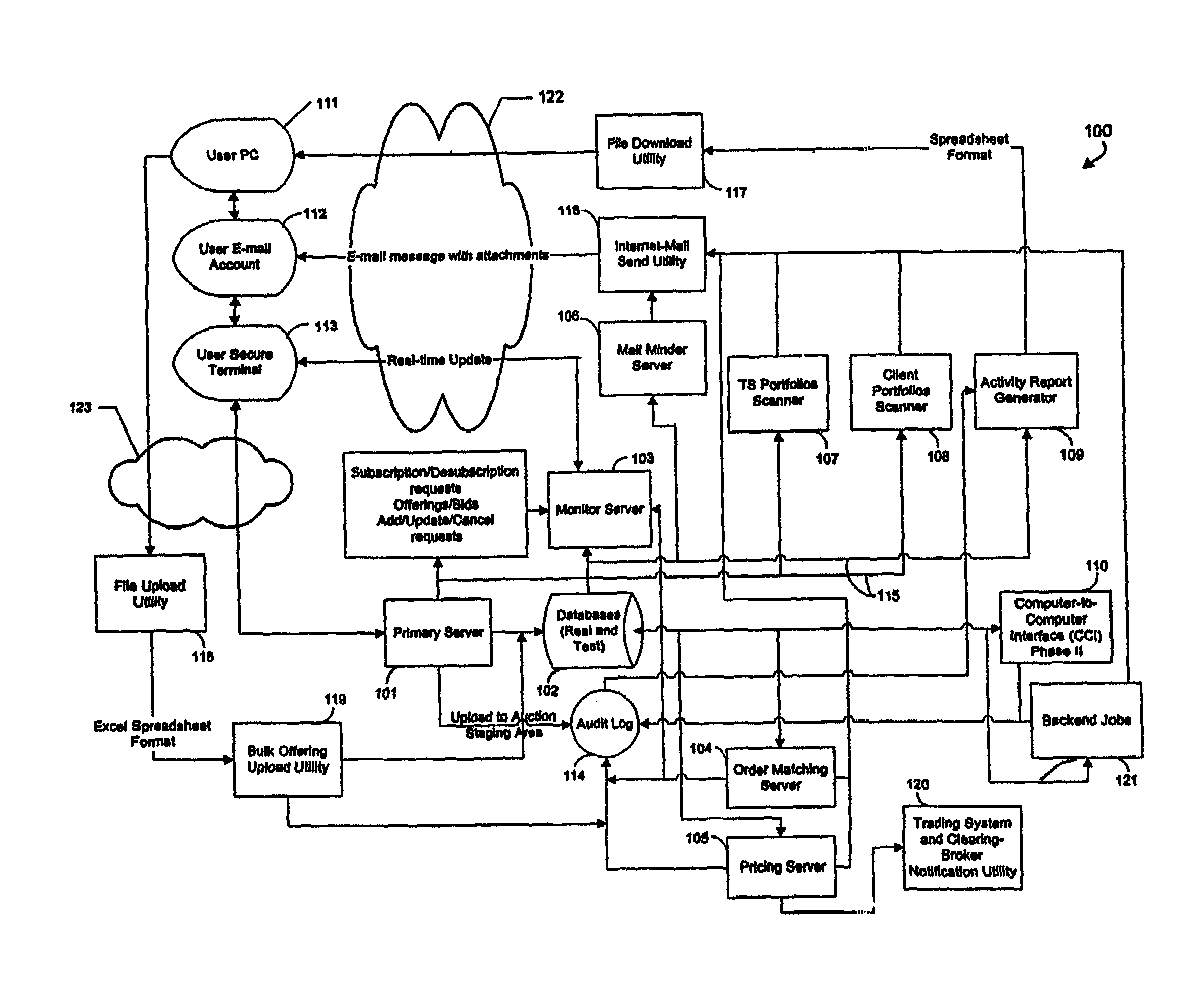

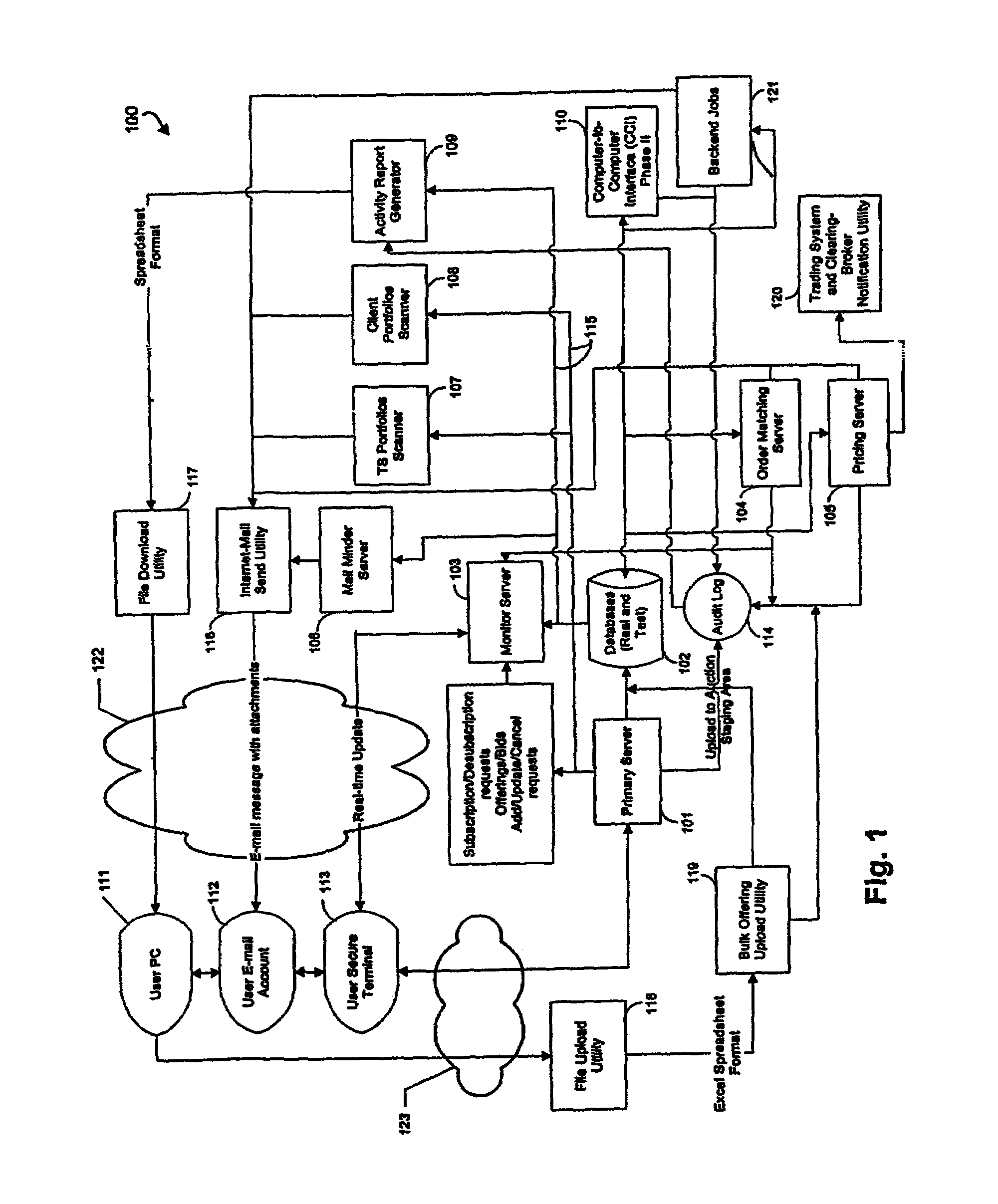

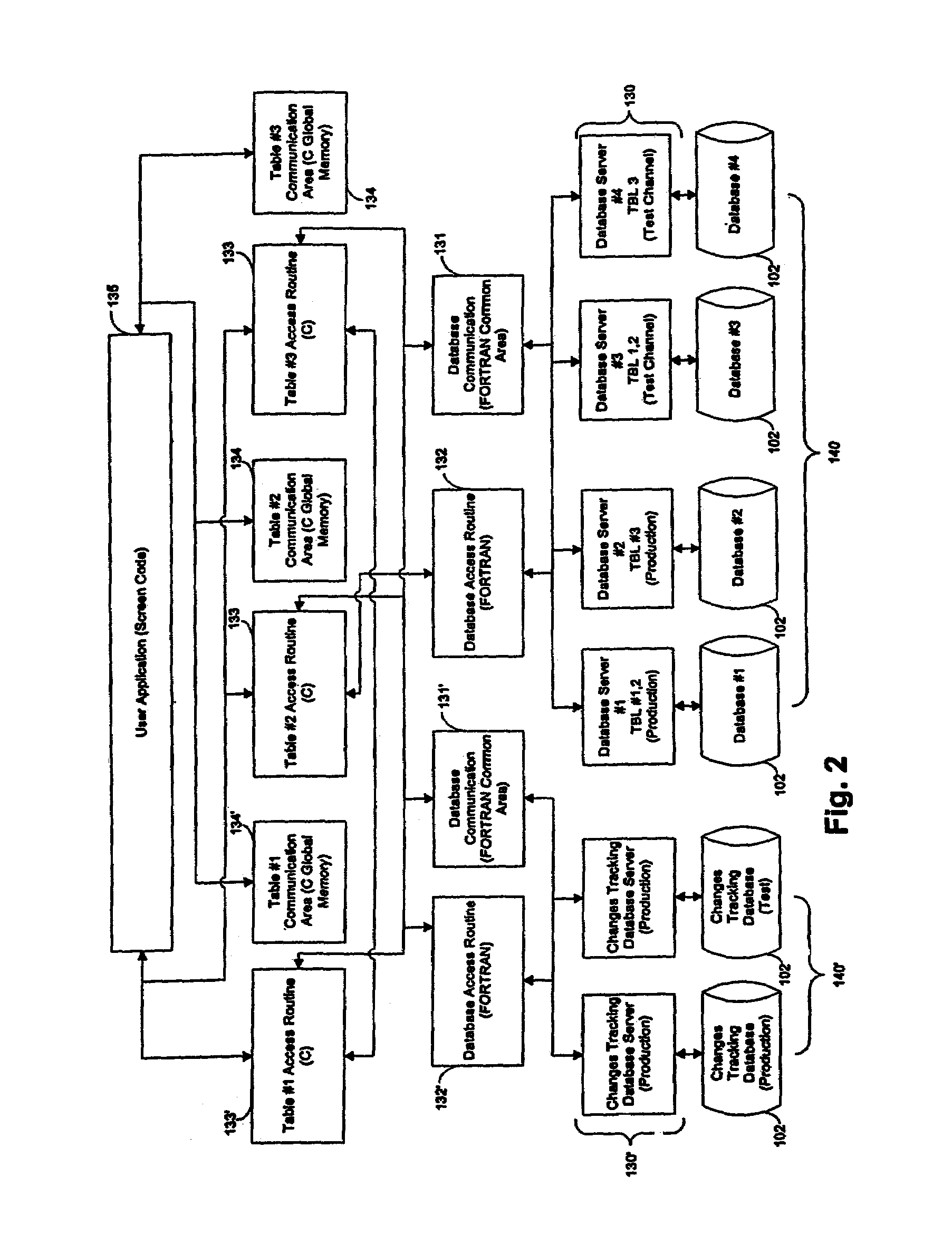

Computer trading of financial interests

Methods, systems, and apparatus for improved trading of financial interests via a computer network are disclosed. Improvements include crossing or commingling of auction and non-auction transaction proposals; disclosure of high bids and of identify of high bidders and offerors during the auction process; presentation of reference benchmark prices and benchmark-derived price references; immediate rescission of multiple proposed transactions in case of emergency; time-limited passwords; assignment of user access level classes; keyword tagging or identification of offers or bids; the use of multiple data sets or trading channels to enable separation of accounting and to accommodate training and familiarization efforts; enabling the creation of data sets in outside programs and subsequent and optionally repeated uploading or importation of data to the auction system; and staging of transactions for supervisory review. The invention includes methods and processes as well as suitable computer programs and data processing systems.

Owner:BLOOMBERG

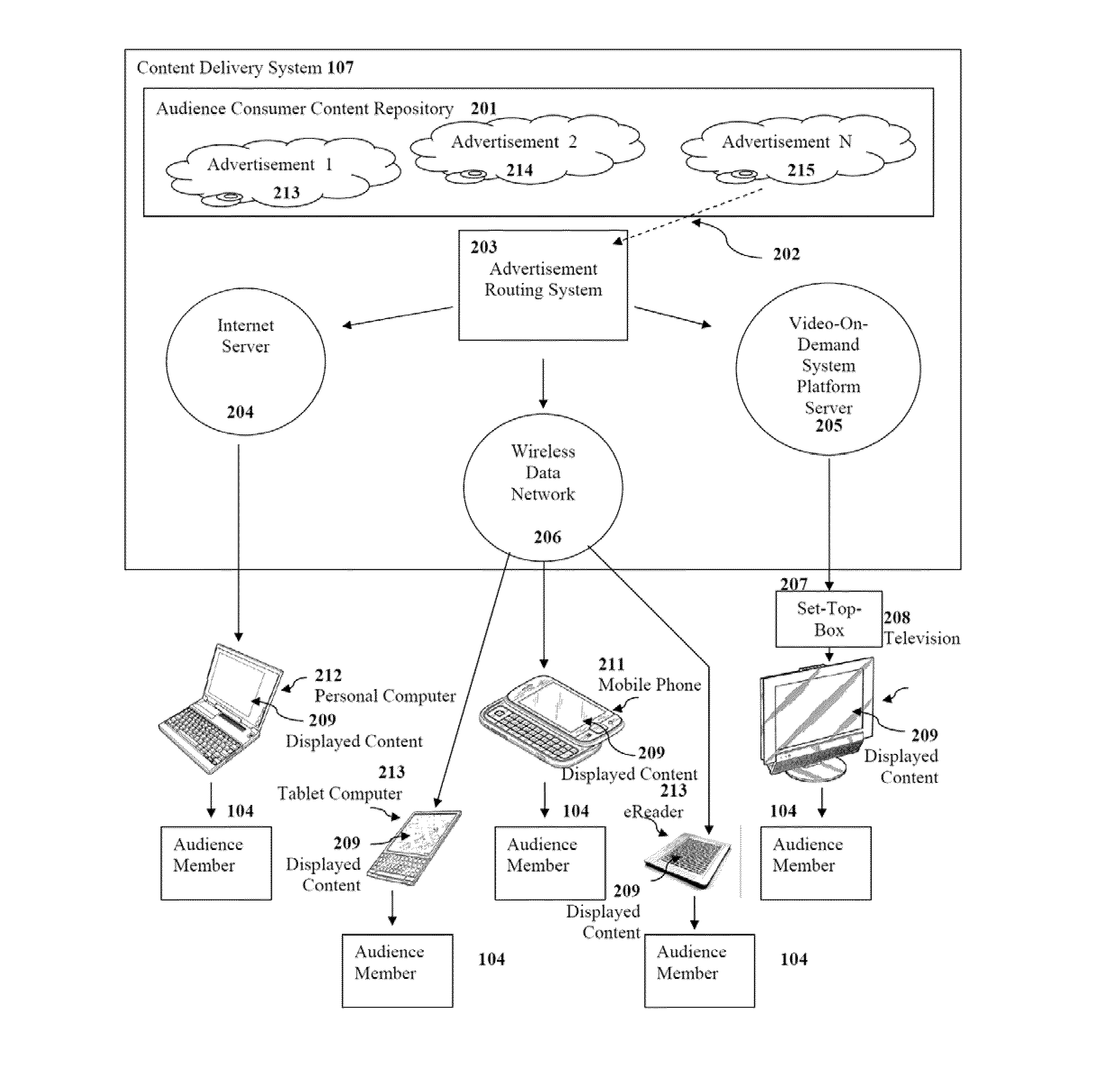

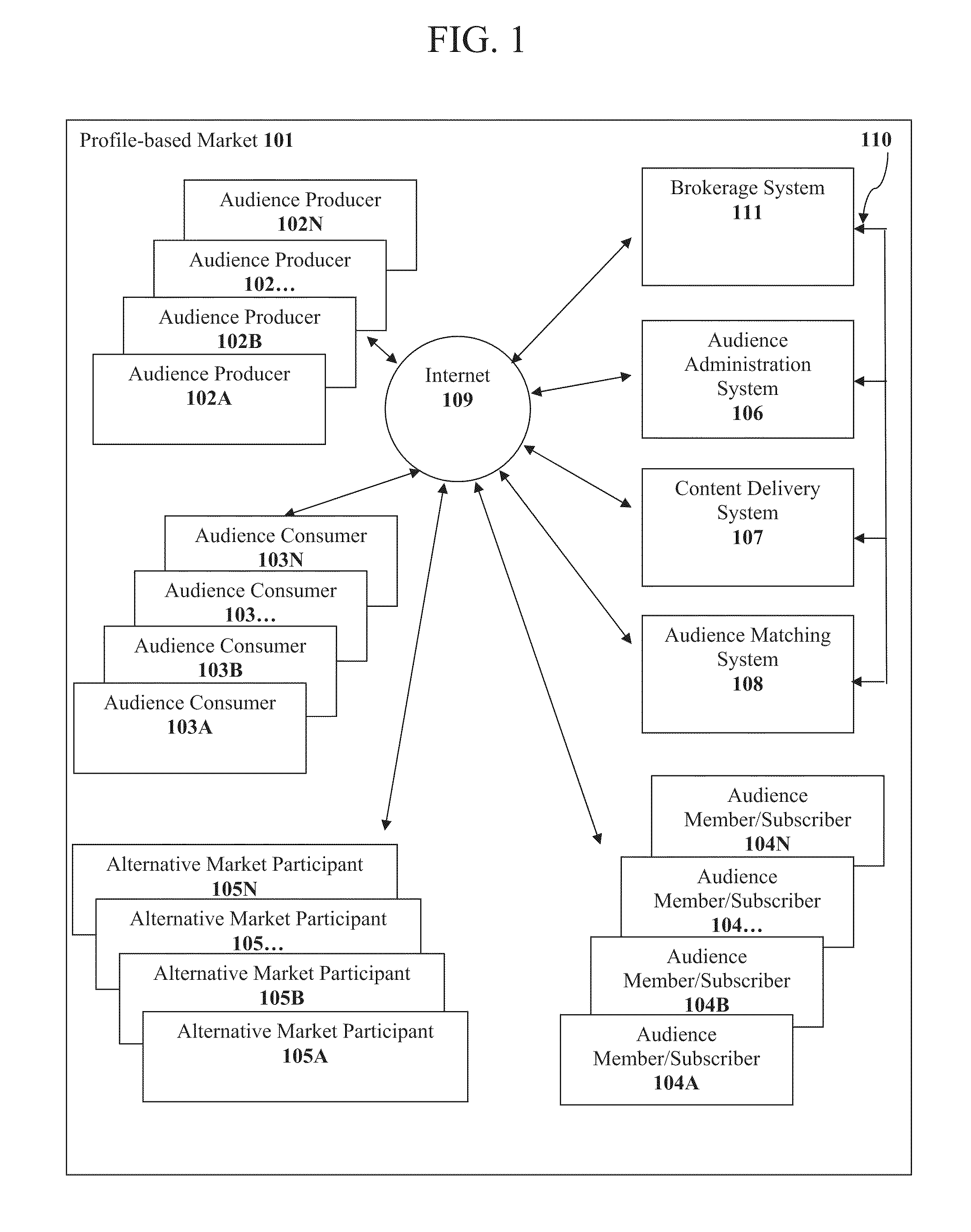

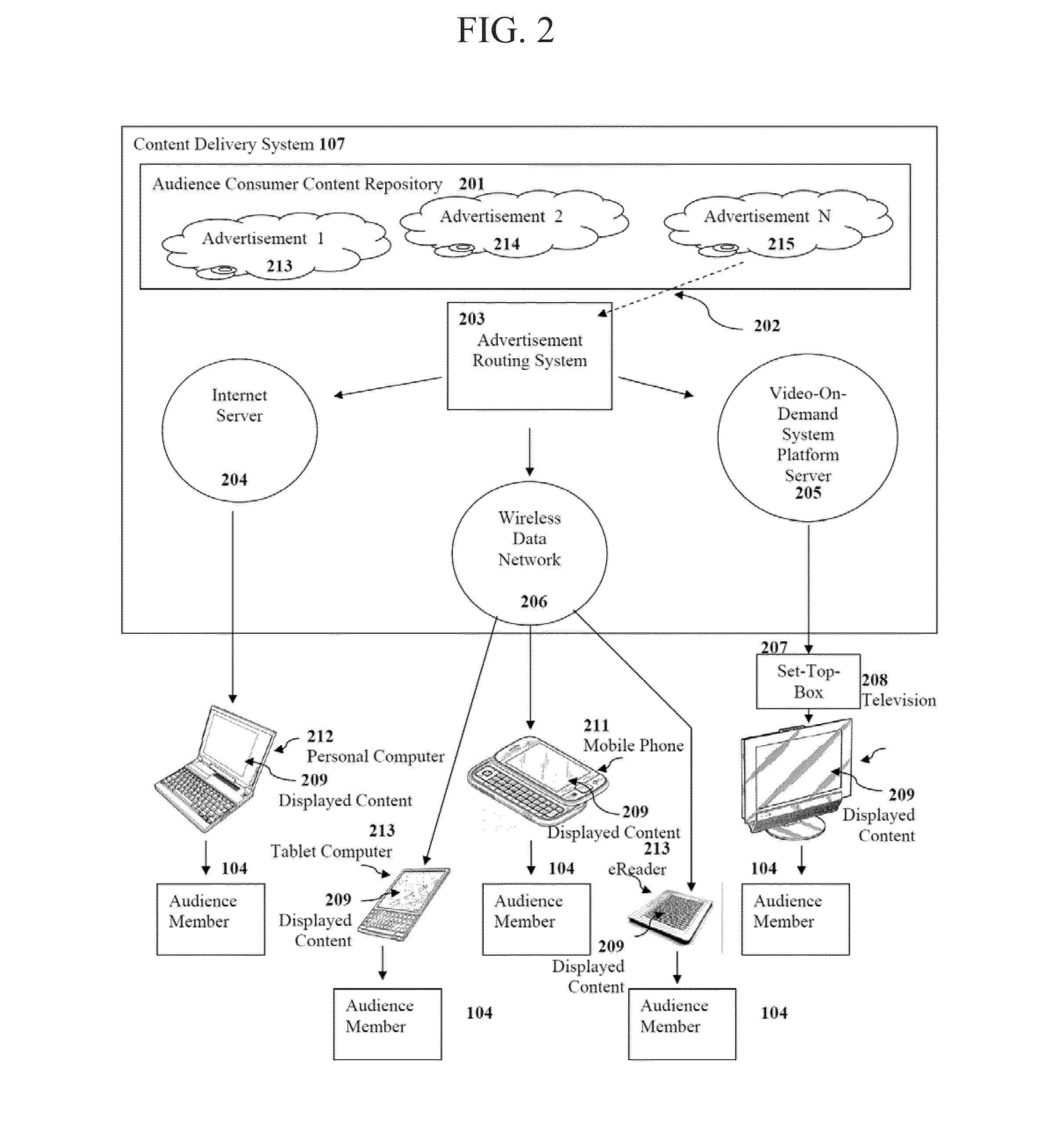

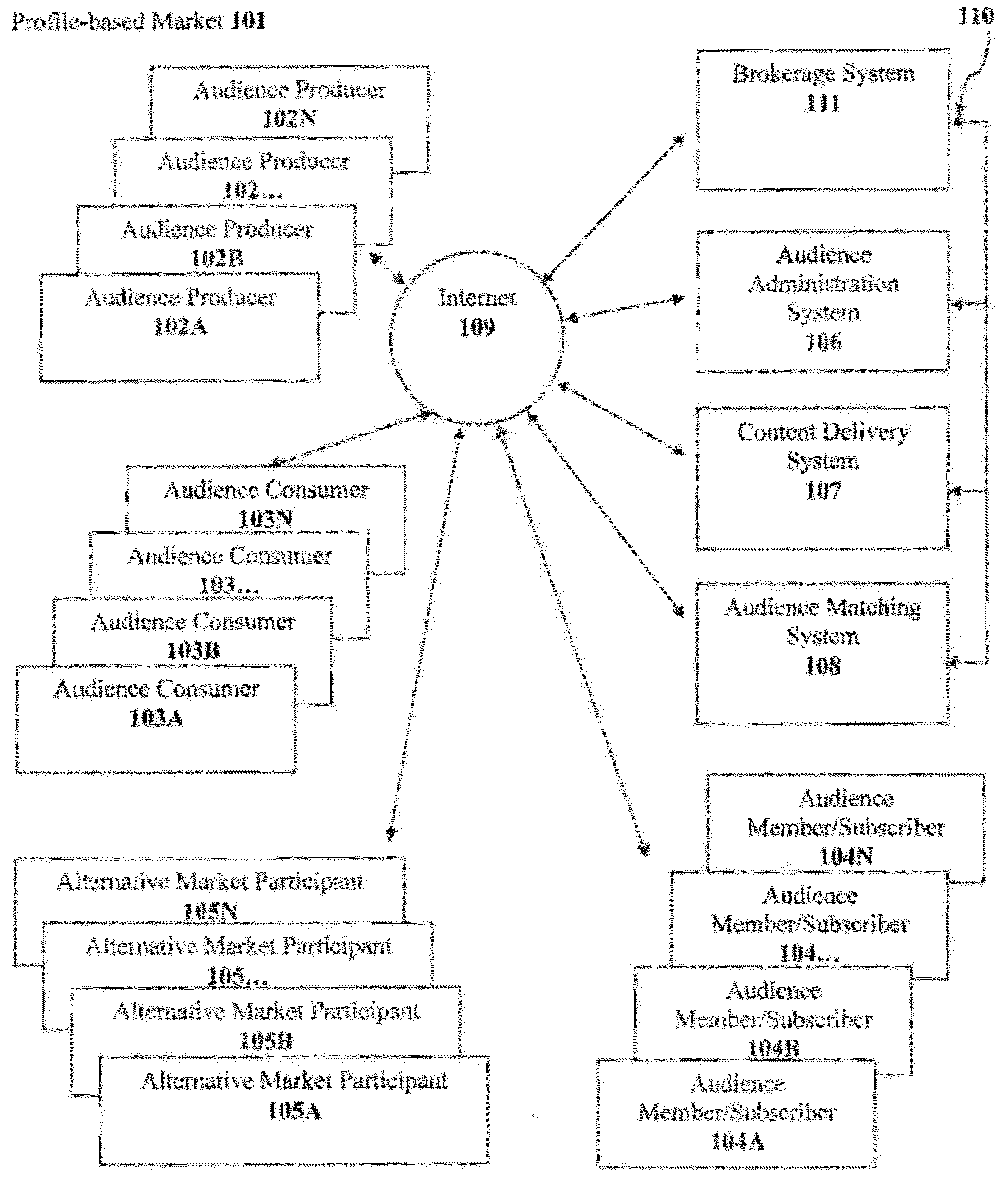

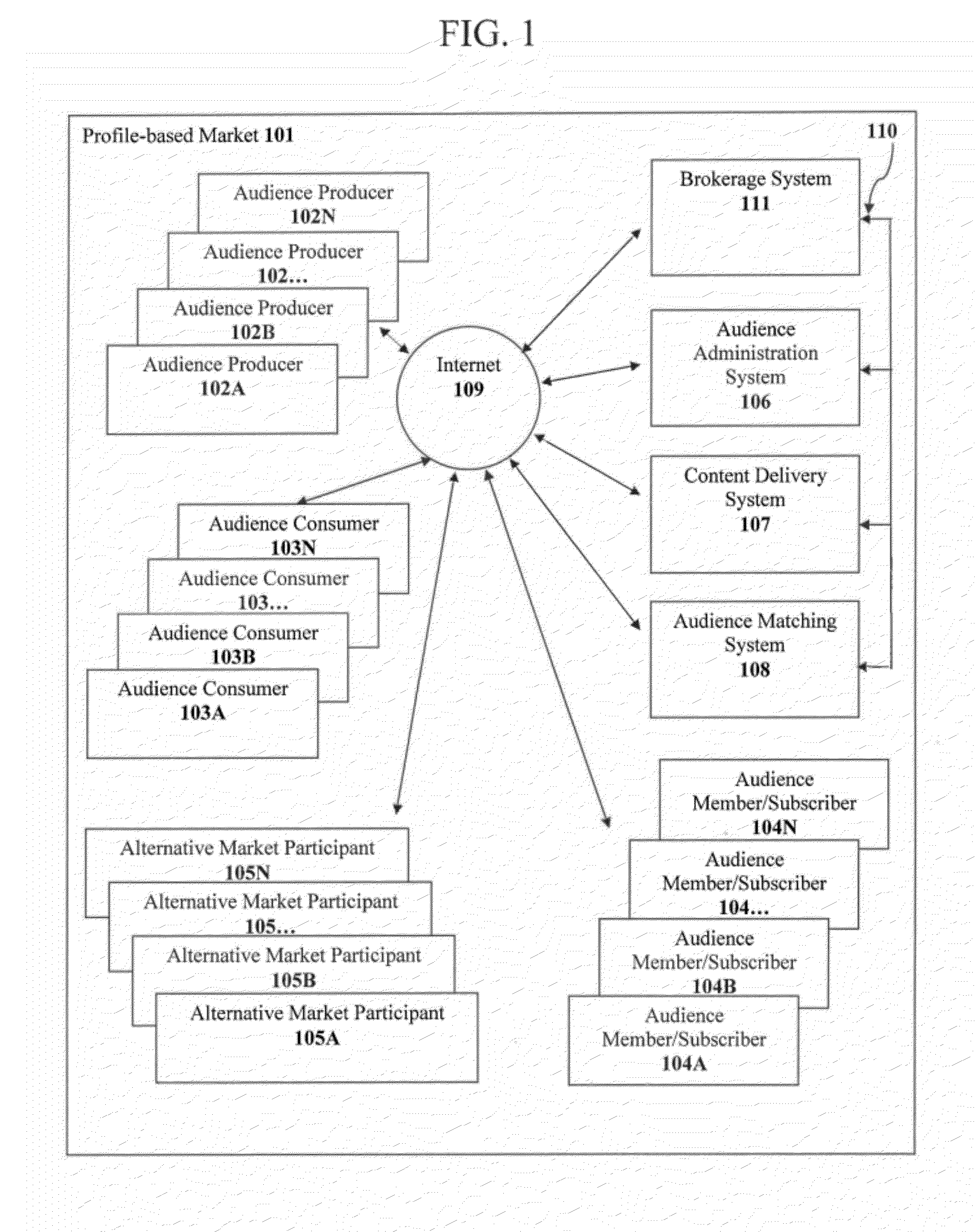

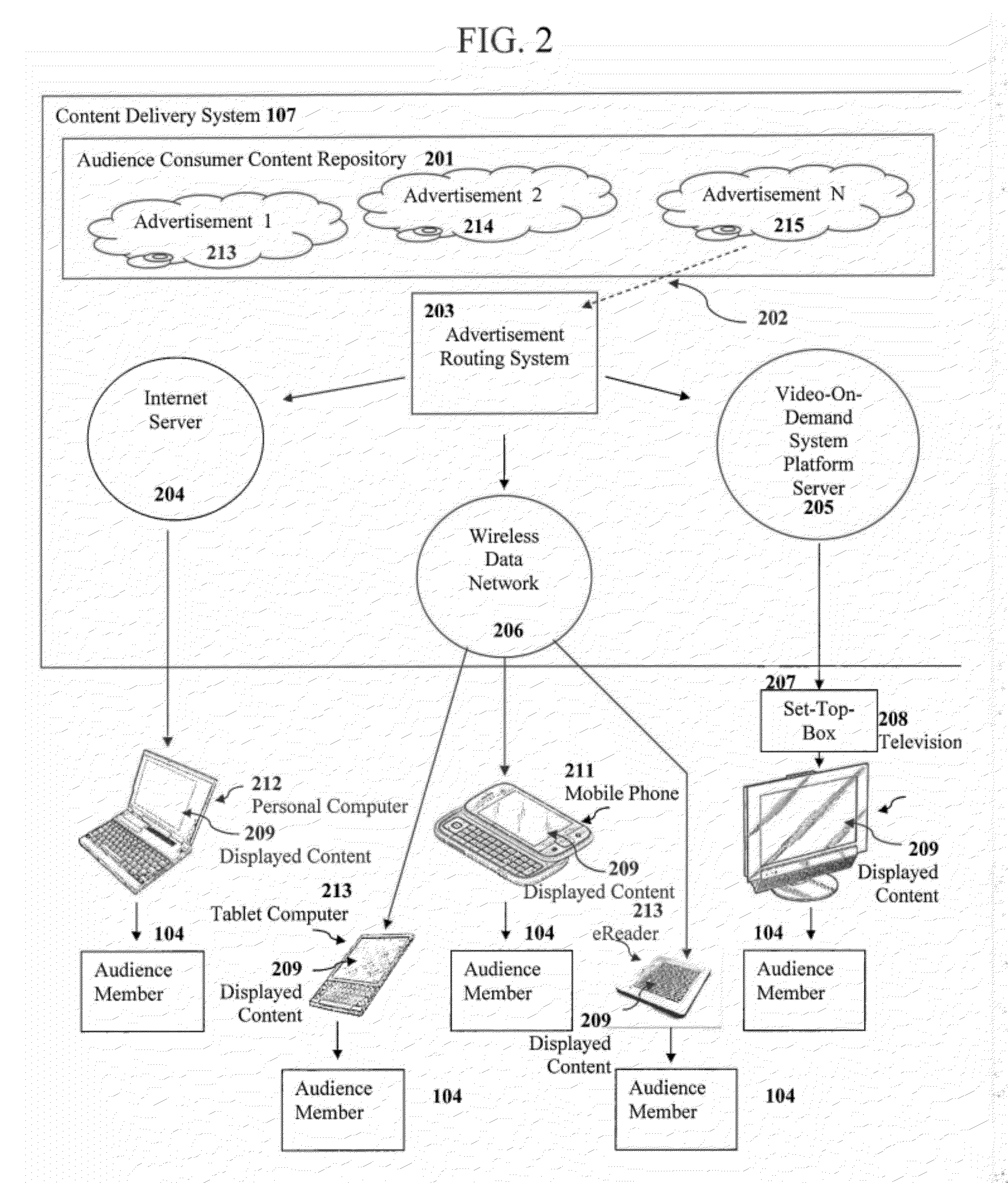

Methods, Systems, and Computer Program Products For Managing Organized Binary Advertising Asset Markets

Binary advertising markets are developed where personalized media such as digital and even analog advertising is delivered to and accessed by audience members enabling advertisers to buy advertising for broadcast to televisions, smartphones and other types of digital devices. The market is designed to provide participants a new way to have their orders entered, matched, executed, and settled, to manage and monitor risk characteristics of their content placement or advertising placement transactions, and any rights and positions that result from those transactions. Standardized units of exchange represented by profile access rights and display space access rights appropriately designed for their respective markets are used in both primary direct and secondary alternative markets. Processes are also implemented where an audience member receives economic benefit in exchange for confirming view of or rating an advertisement, or viewing advertisements while logged in.

Owner:MANAGED AUDIENCE SHARE SOLUTIONS

Apparatus, method and system for providing an electronic marketplace to join a trade for credit default swaps and other financial interests, and to deal-by-volume for the interests

ActiveUS8626637B1Improve accessibilityEasy to deployFinanceDigital computer detailsLibrary scienceCredit default swap index

A computer-implemented method of trading an interest, which includes executing a trade for the interest between counterparties, locking the interest for further executions, providing an opportunity to the counterparties to work-up the trade, providing an opportunity to a trader not a counterparty to the trade to join in the trade, receiving a request from the trader to join the trade; and joining the trader in the trade.

Owner:GFI GROUP INC

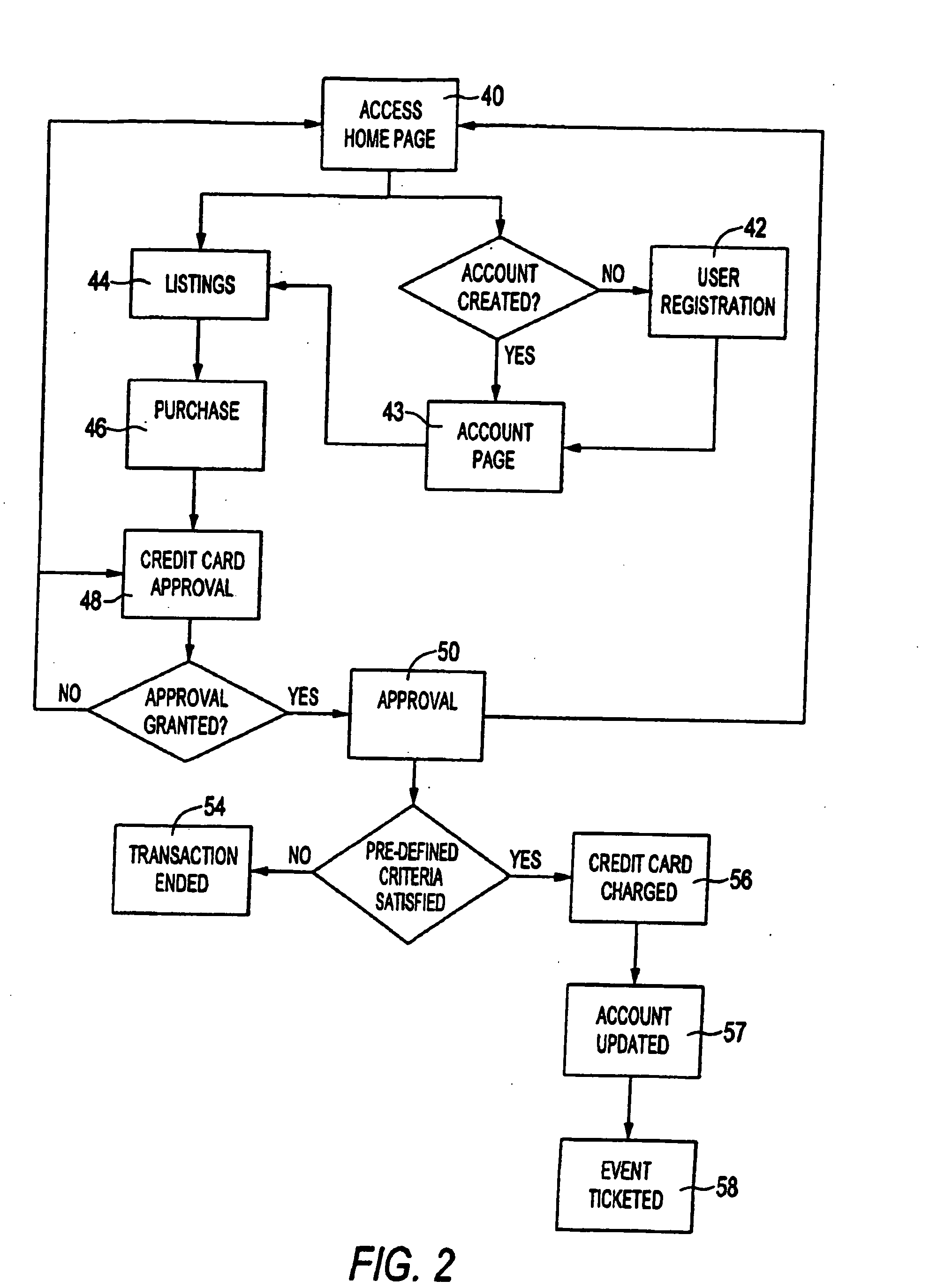

Systems and methods for making conditional sales of investments

Methods and systems for raising capital through the conditional sale of investments online, wherein each investment provides an owner with a financial interest in an entity that (i) produces, develops, provides or has a financial interest in a specified good, service, event, achievement, or venture; or (ii) commits to produce, develop, provide or gain a financial interest in said good, service, event, achievement, or venture.

Owner:KICKSTARTR

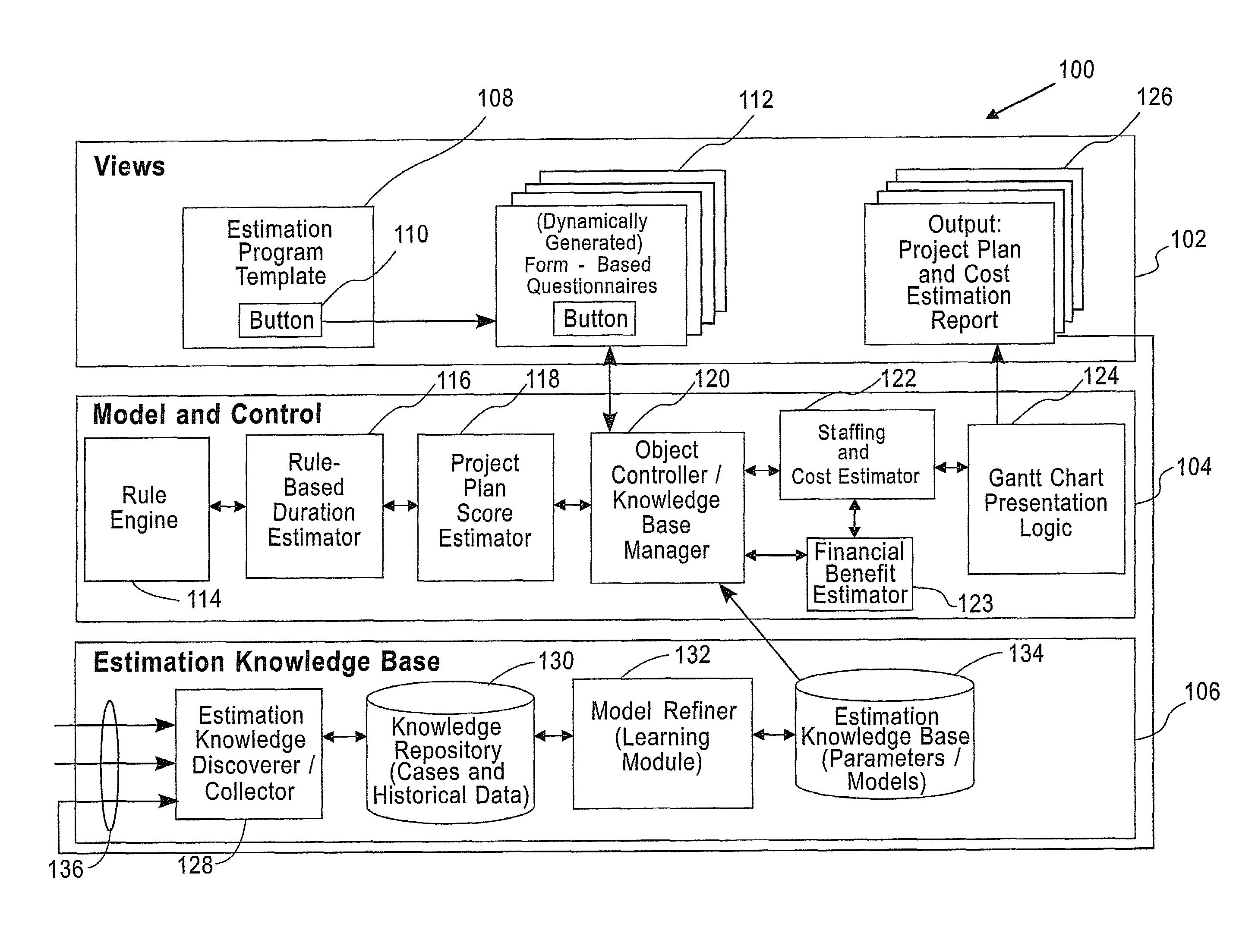

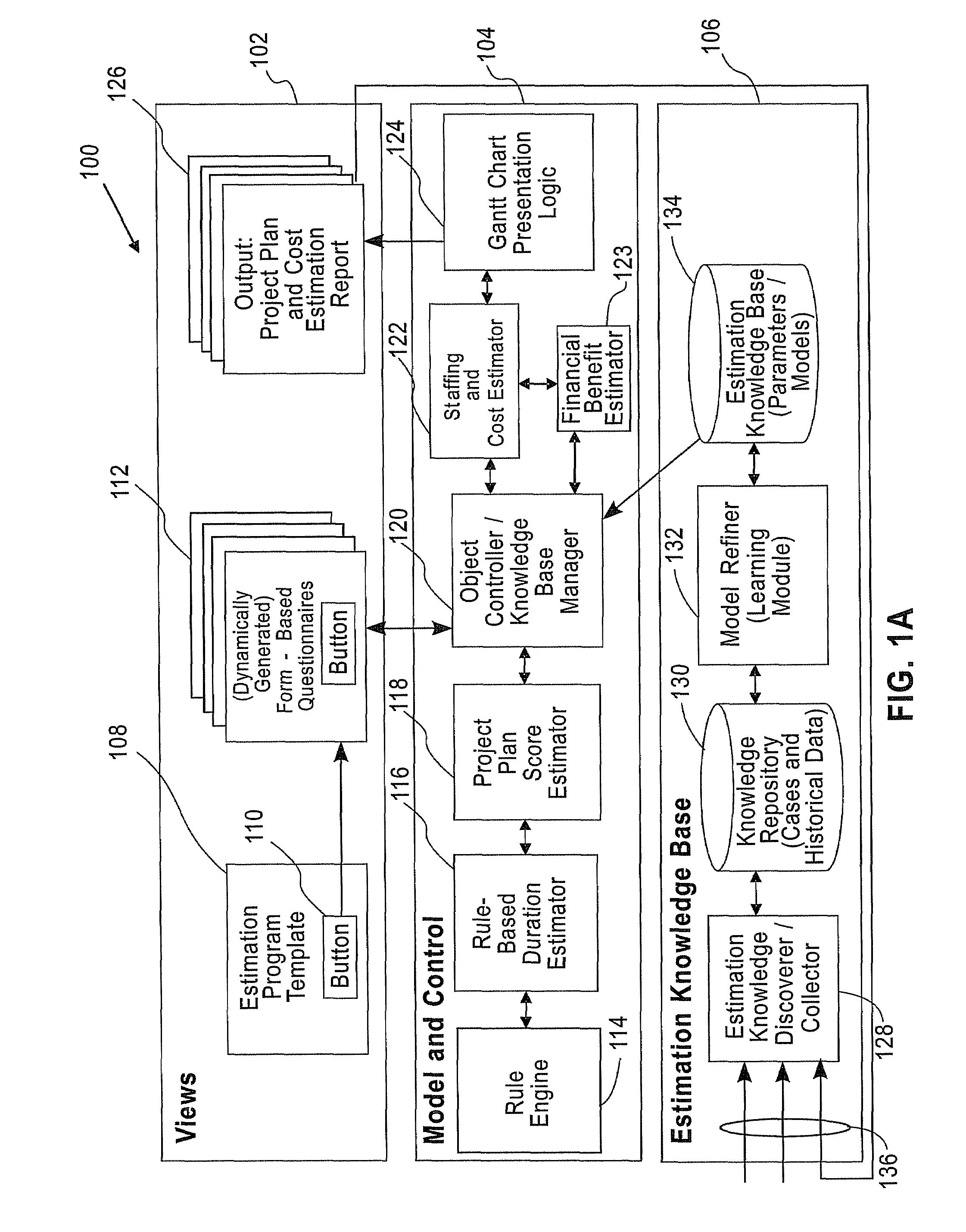

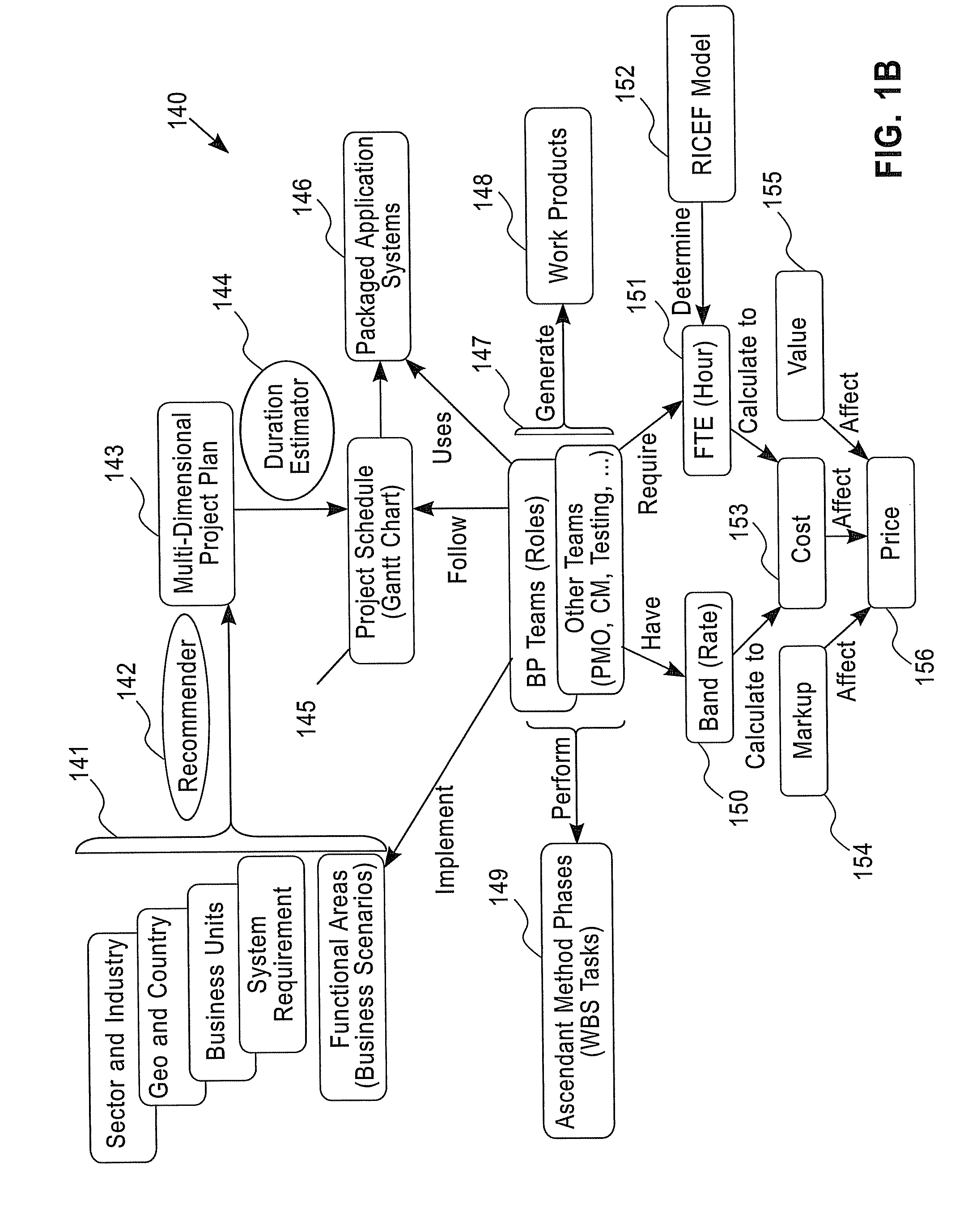

Method and system for estimating financial benefits of packaged application service projects

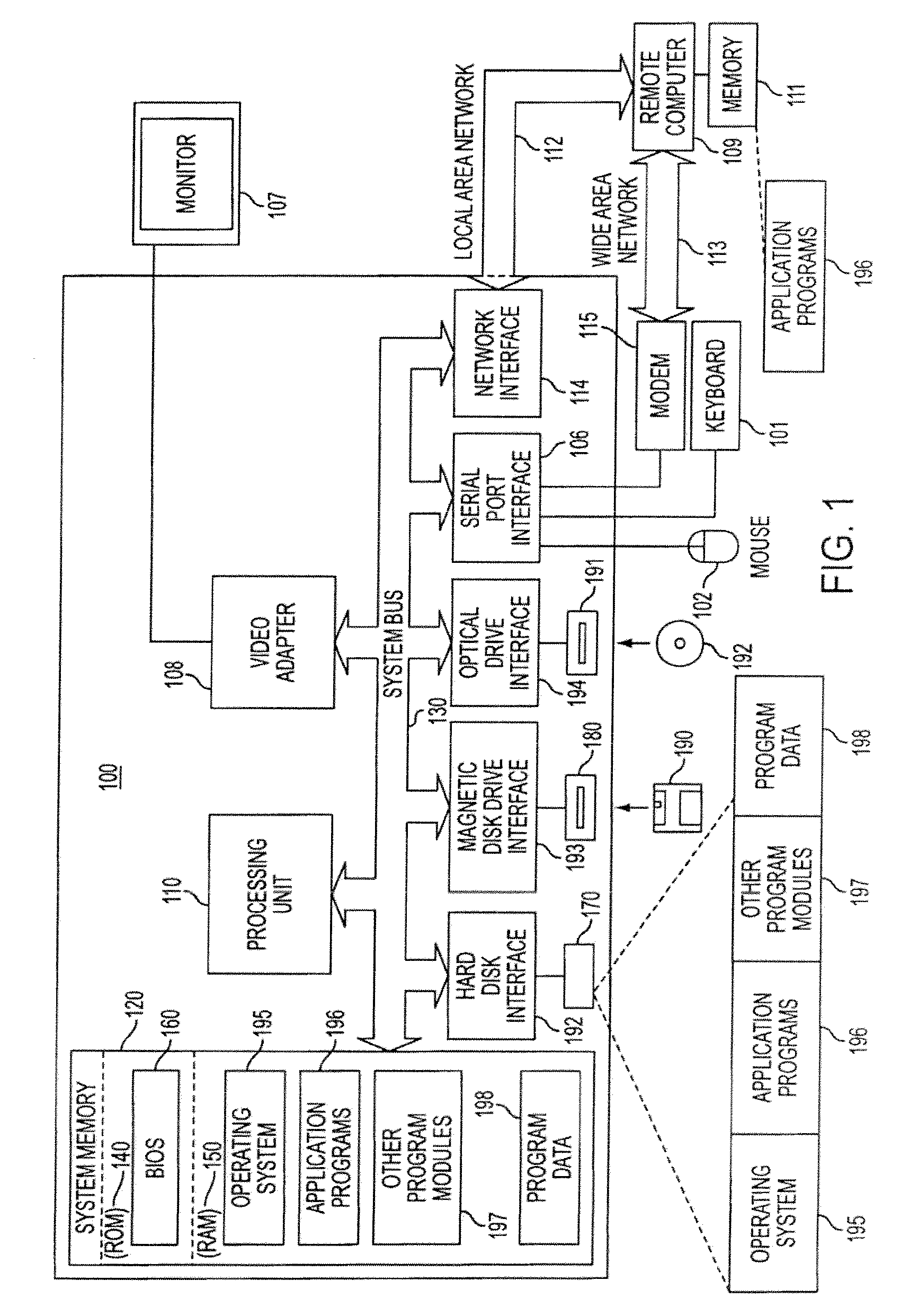

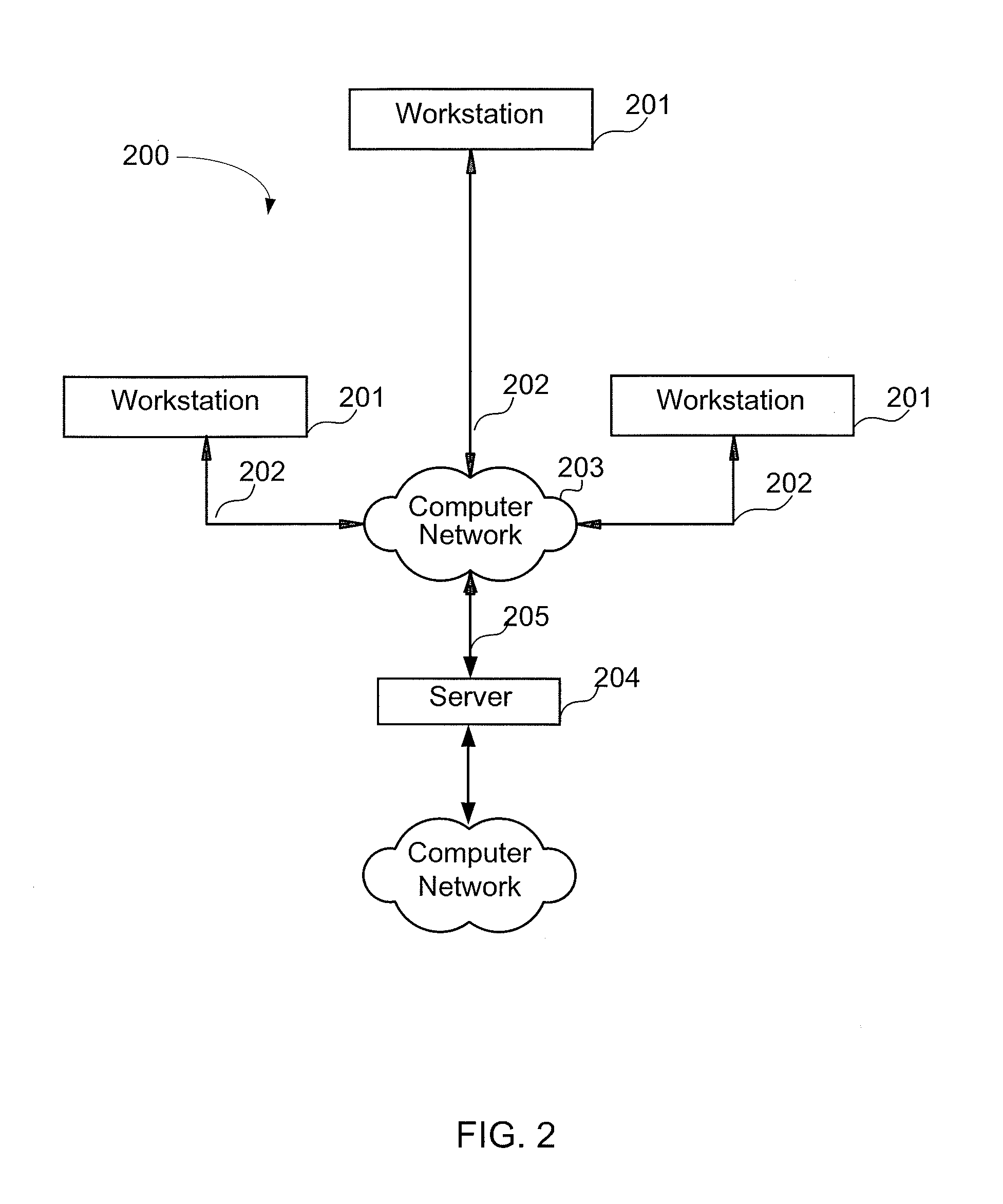

A system for calculating financial benefit estimations and generating reports for multi-dimensional project plans for implementing packaged software applications, the system includes: a view layer configured to act as a user interface for user inputs and system outputs; a model and control layer configured to implement rules based on a series of estimation and implementation models, and to perform calculations to determine financial benefits of implementing multi-dimensional project plans; an estimation knowledge base layer configured to hold and derive the series of estimation and implementation models; and wherein the system for generating financial benefit estimations and reports for the implementation of packaged software applications is carried out over networks comprising: the Internet, intranets, local area networks (LAN), and wireless local area networks (WLAN).

Owner:IBM CORP

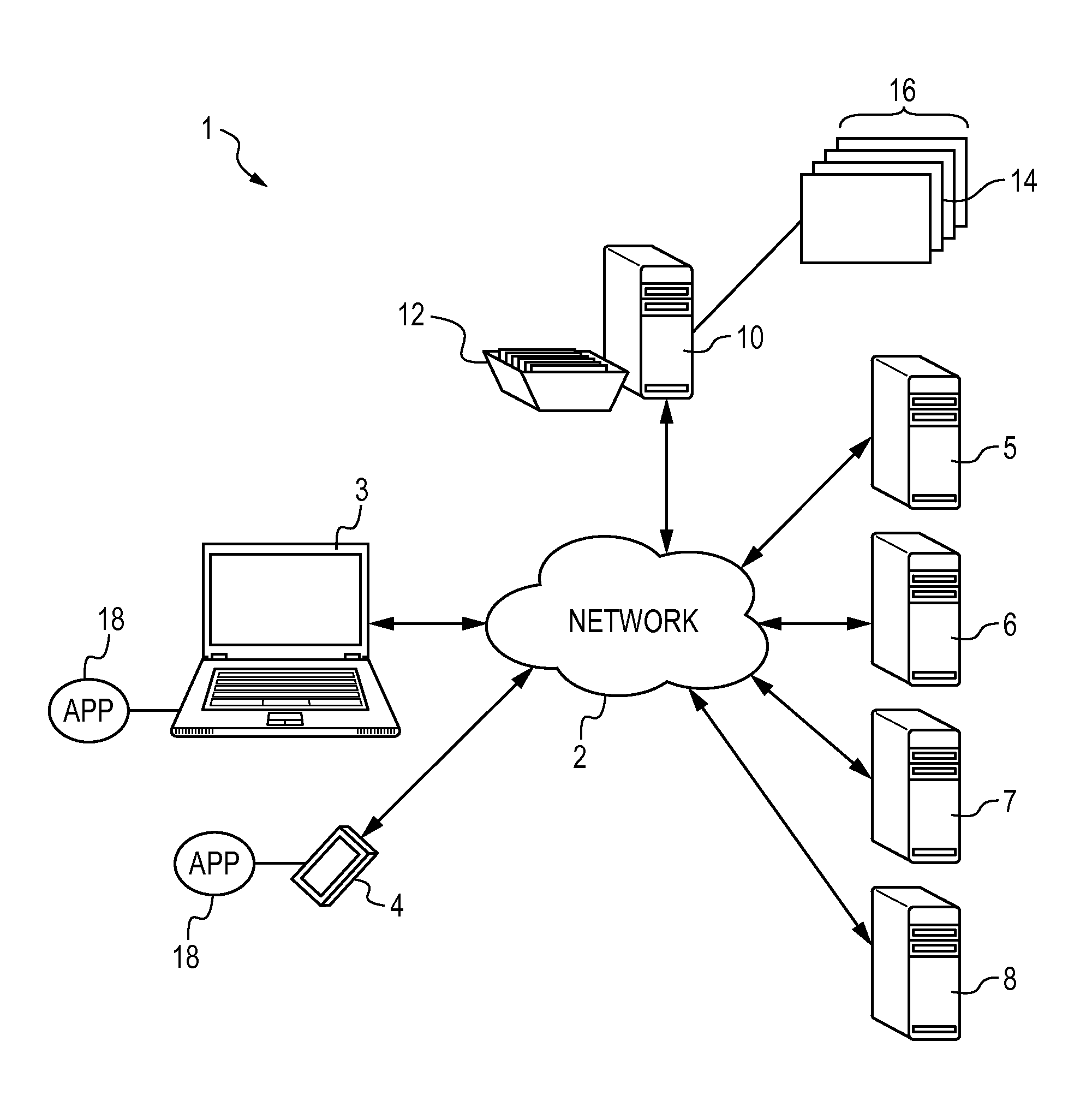

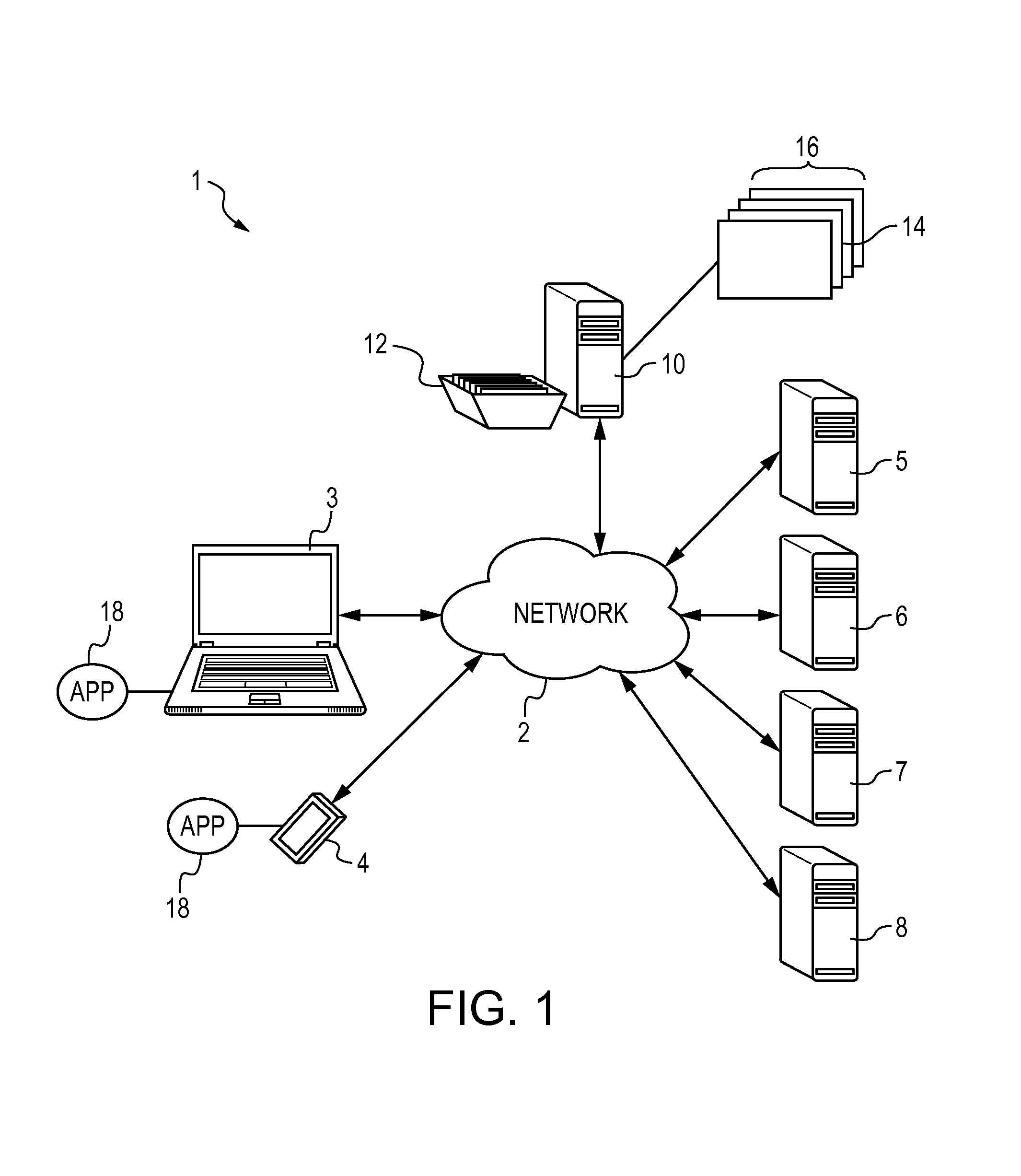

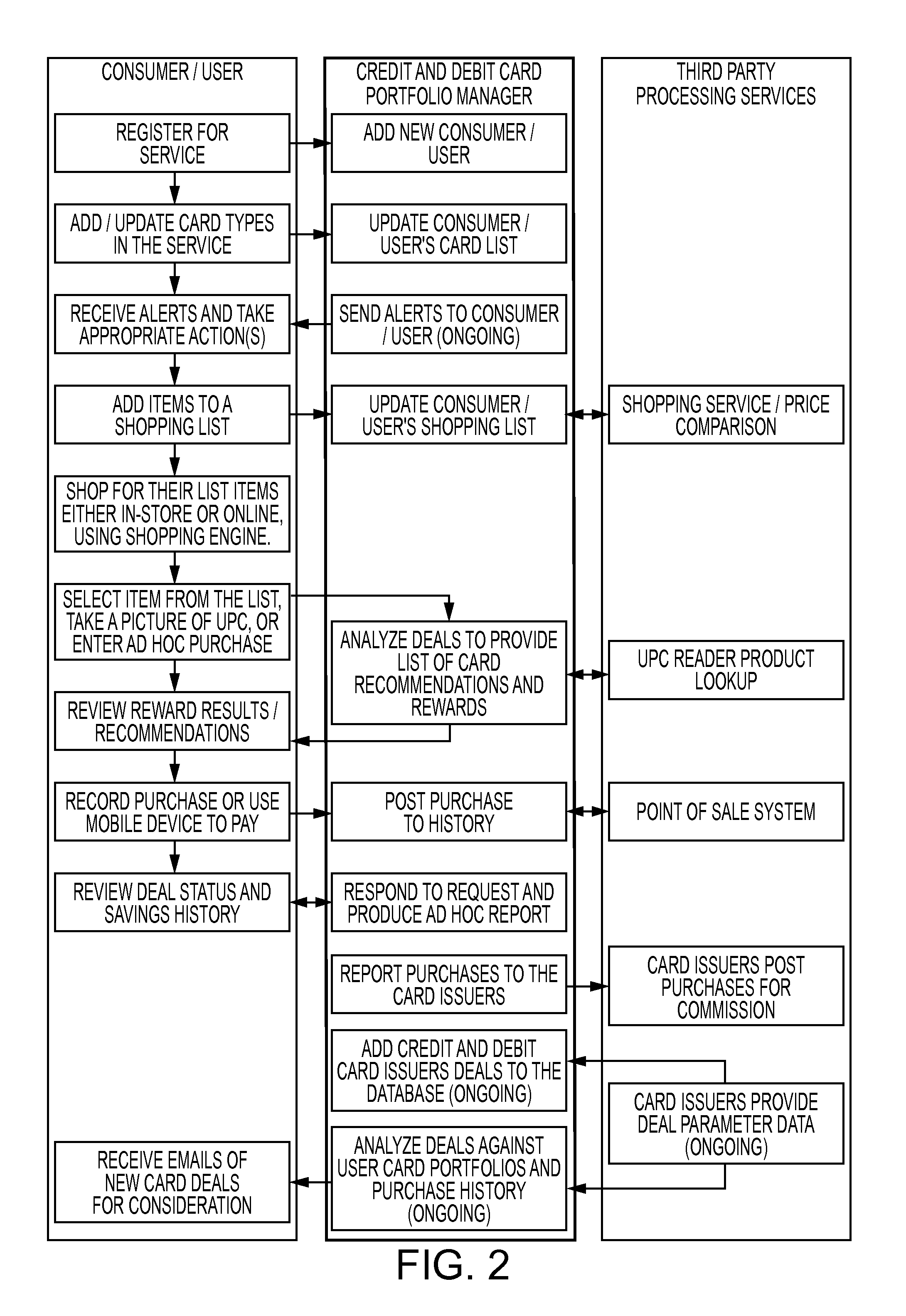

Method and system for optimizing the usefulness of a credit and debit card portfolio

ActiveUS8540151B1MaximizeEconomic benefit maximizationFinanceCredit schemesComputer scienceFinancial interest

A method, for maximizing the financial benefits that accrue to one from optimally taking advantage of the incentives offered by the various providers of credit cards, includes the steps of: (1) collecting card provider information regarding currently offered incentives, (2) collecting one's information regarding past and proposed card purchases, (3) analyzing this information to determine the benefits that would accrue to one from making the proposed purchase with each of one's available cards, (4) communicating the results of this analysis so as to enable it to be used in selecting the card to be used in one's next purchase, (5) presenting the incentives of other cards which are not in the one's card portfolio, and (6) if one is considering adding one of these other cards to one's portfolio in order to take advantage of its incentives, advising of the impact on one's credit rating of applying for a new card.

Owner:OPTIWALLET

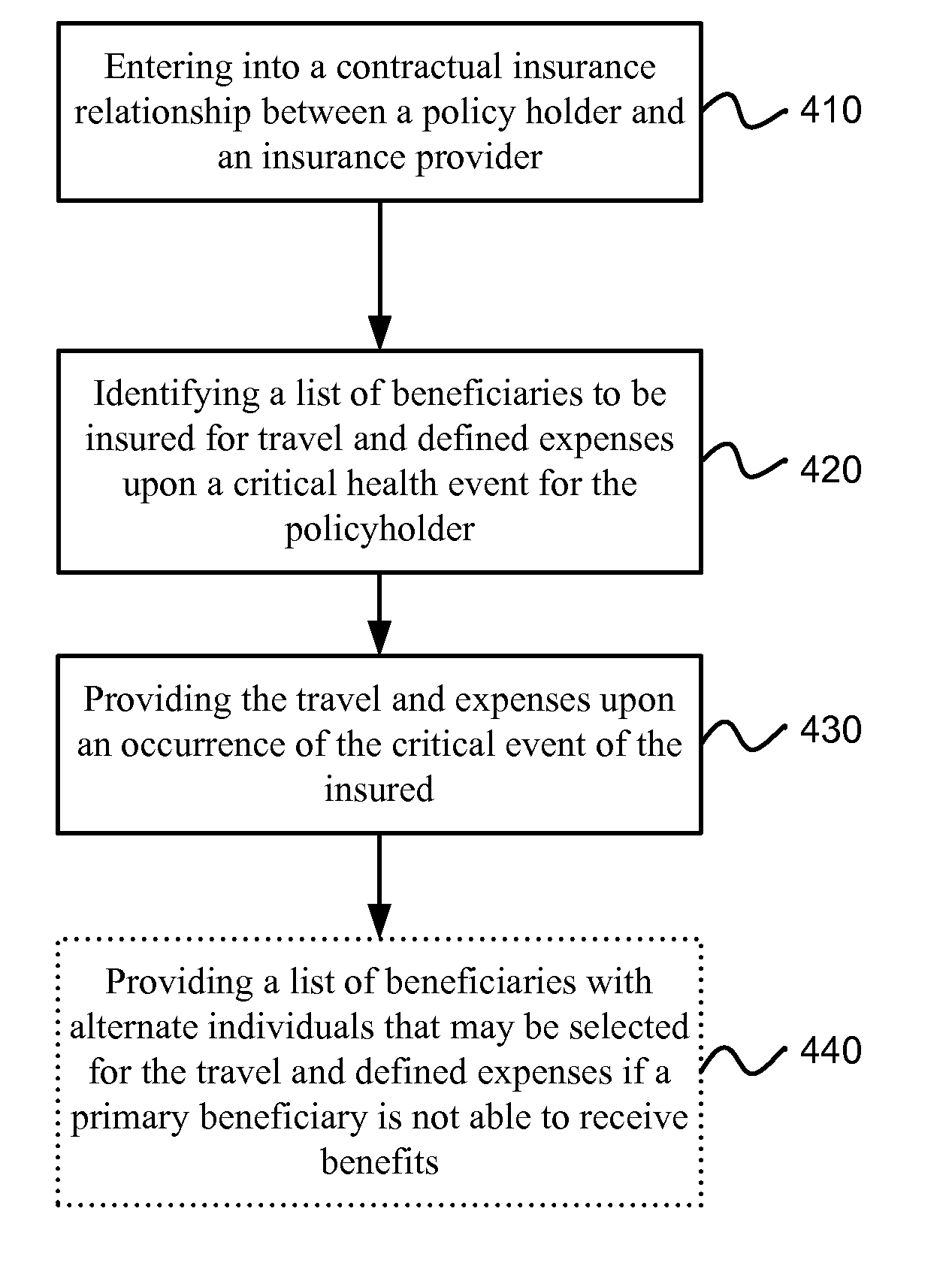

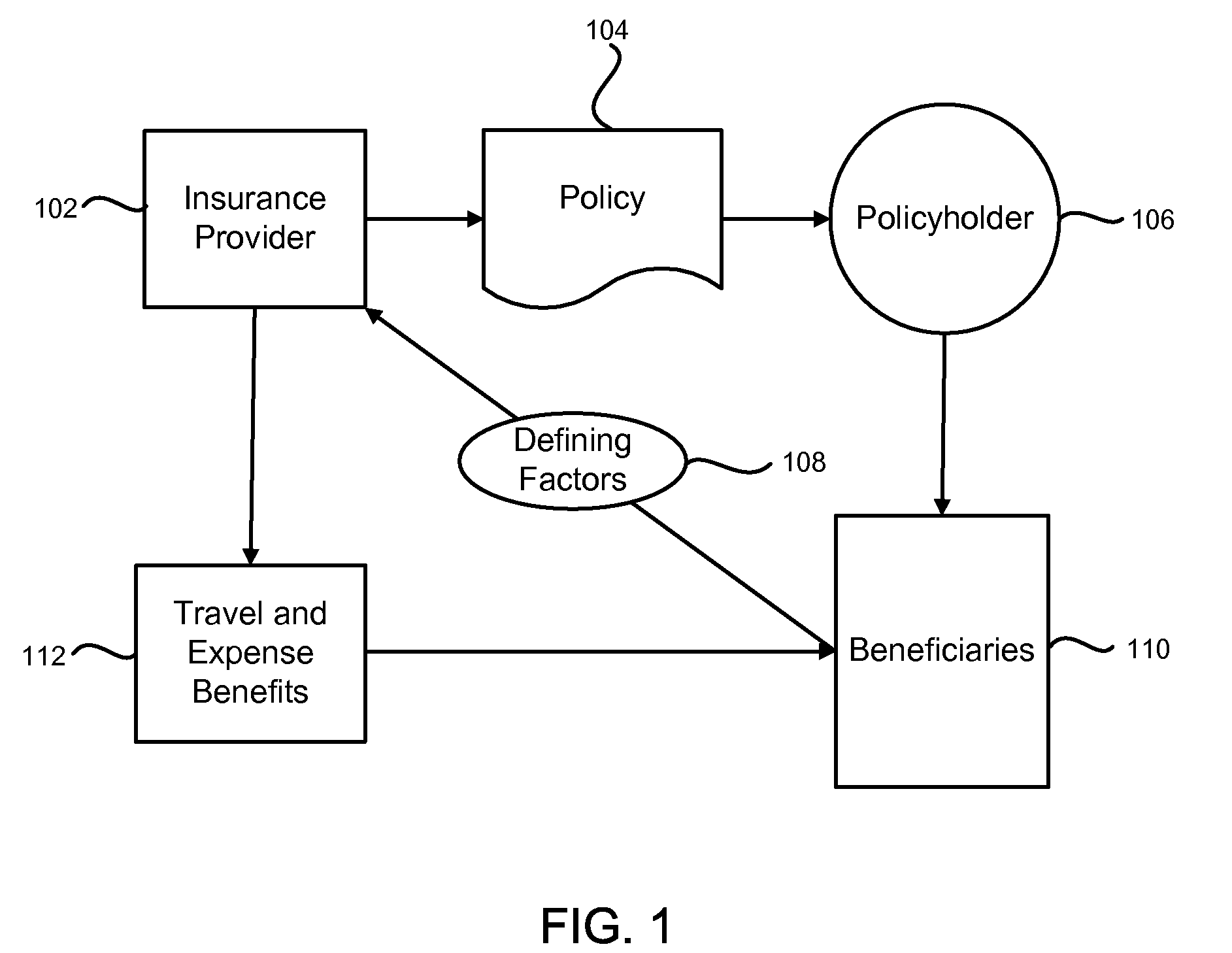

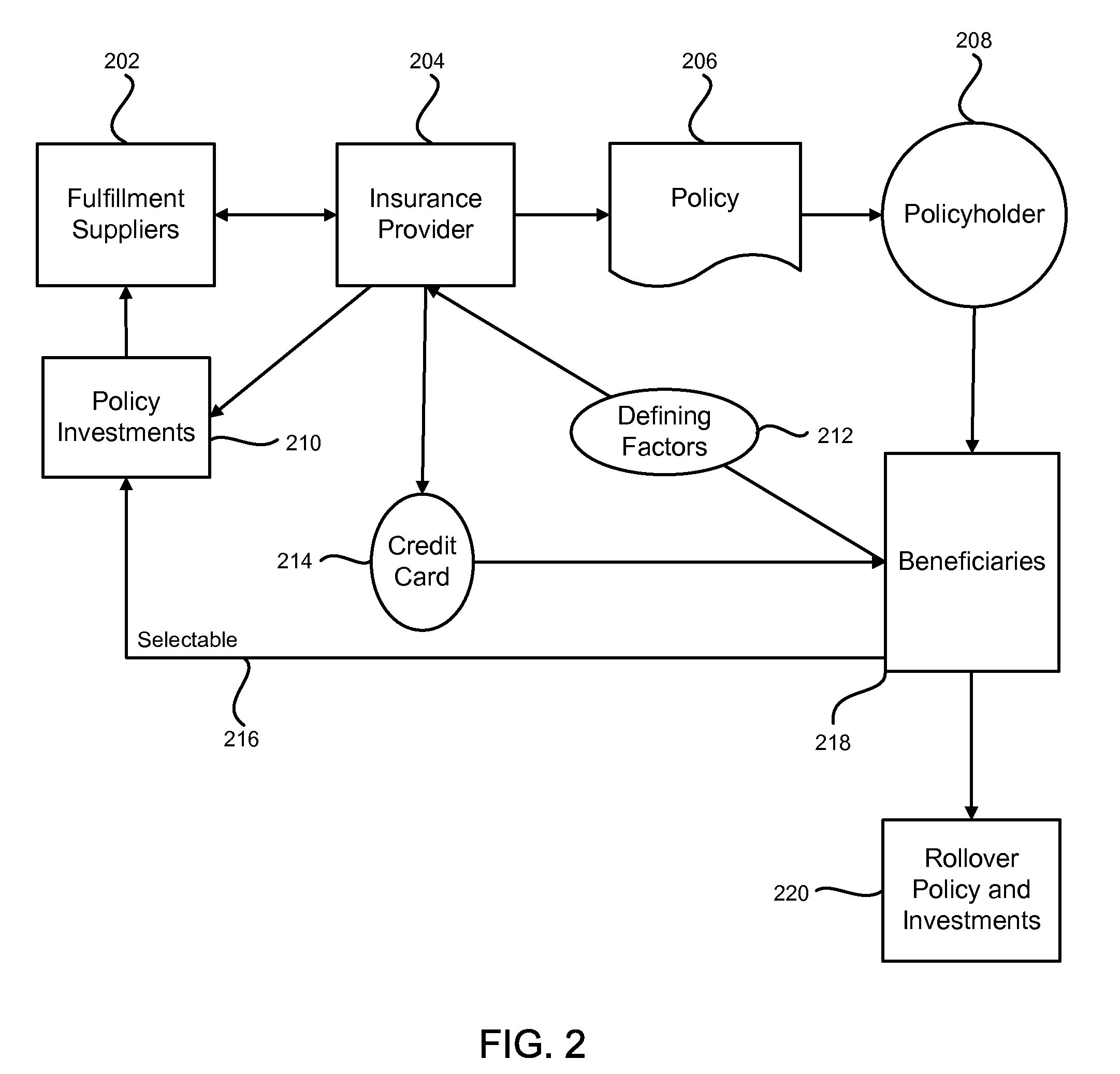

System and method for providing insurance and financial benefits

A system and method of supplying insurance and financial benefits is provided. The method can include the step of entering into an insurance contract between a policyholder and an insurance provider. A beneficiary can be identified to be insured under the insurance contract and to receive selected benefits based on a significant health event for the policyholder. The selected benefits can be provided to the beneficiary upon an occurrence of the significant health event of the policyholder.

Owner:HALL CORY +1

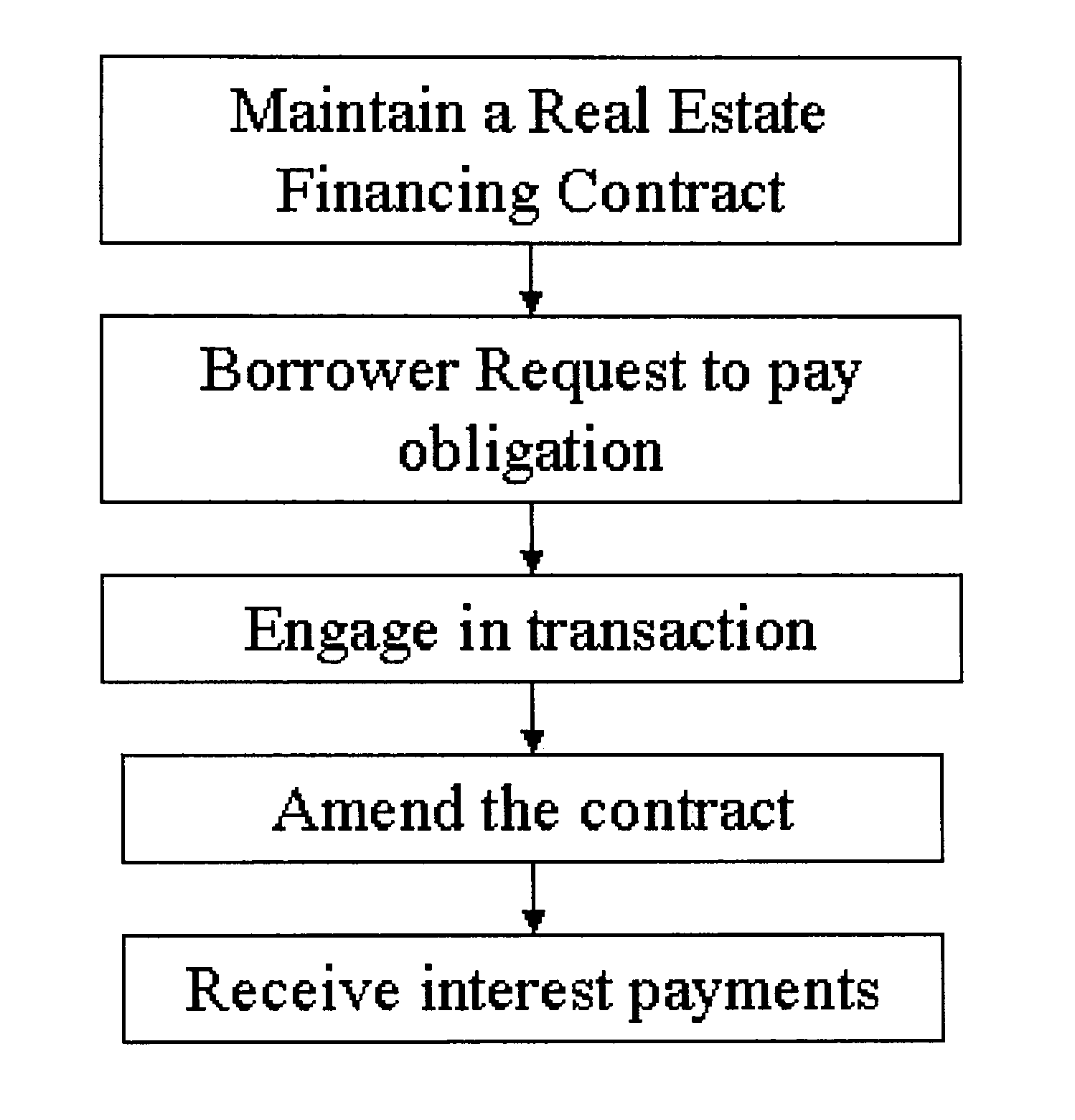

Mortgage loan product

In the present invention, a system and method is provided for making insurance policies and products, consumer goods, property taxes, household obligations and credit card debt more affordable by paying for such items, (collectively known as goods and services) through residential mortgages, home equity lines of credit and any other residential liens, by amending the interest rates or the balances due or a combination of both the interest rate and the balance due on such mortgages. The interest rates and / or balances charged on the aforementioned secured loans will be increased sufficiently to collect enough money each month to pay participating homeowners' monthly payments for their homeowner's insurance or other debts and products they chose to include within their mortgages. Because interest paid on most mortgages is tax deductible, this invention has the potential to offer a significant financial benefit.

Owner:BRASCH WARREN

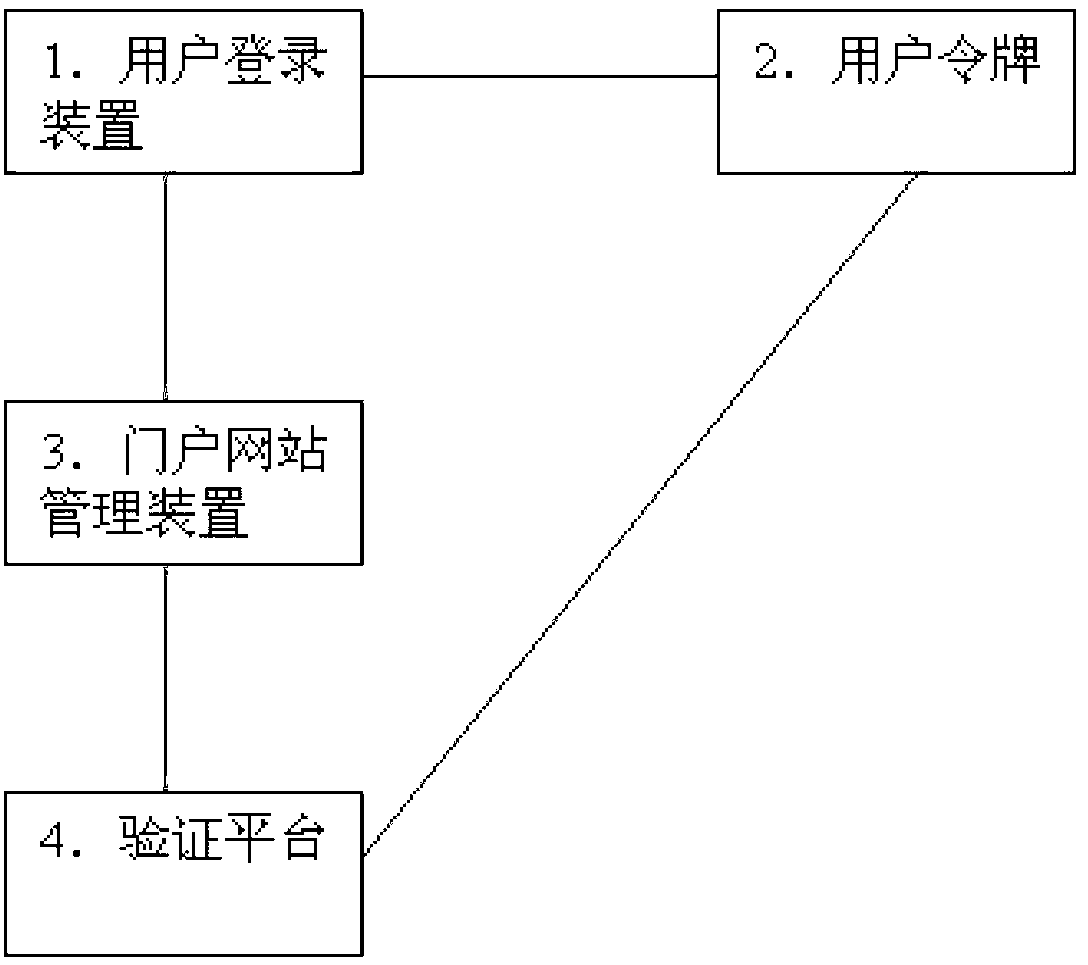

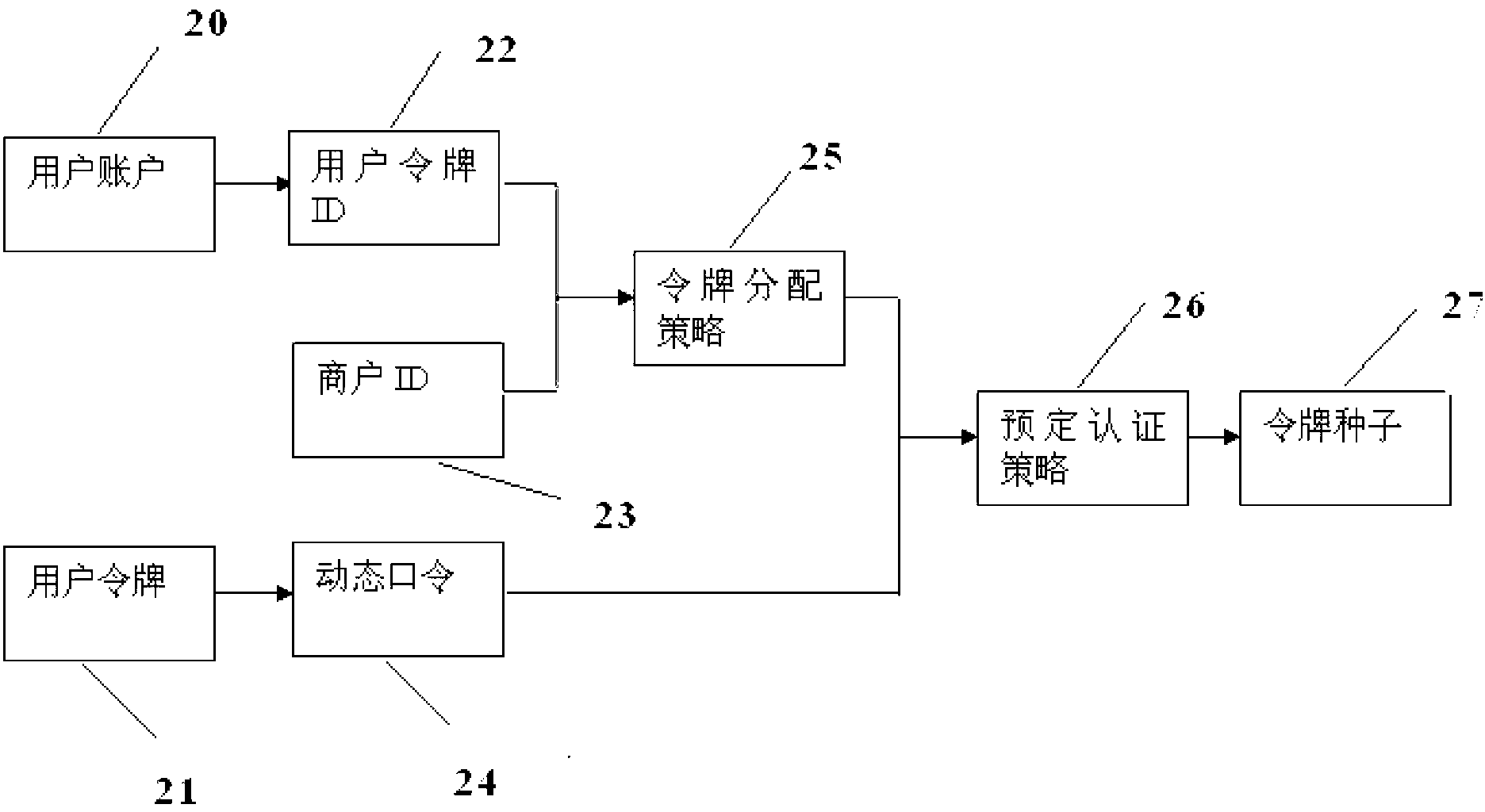

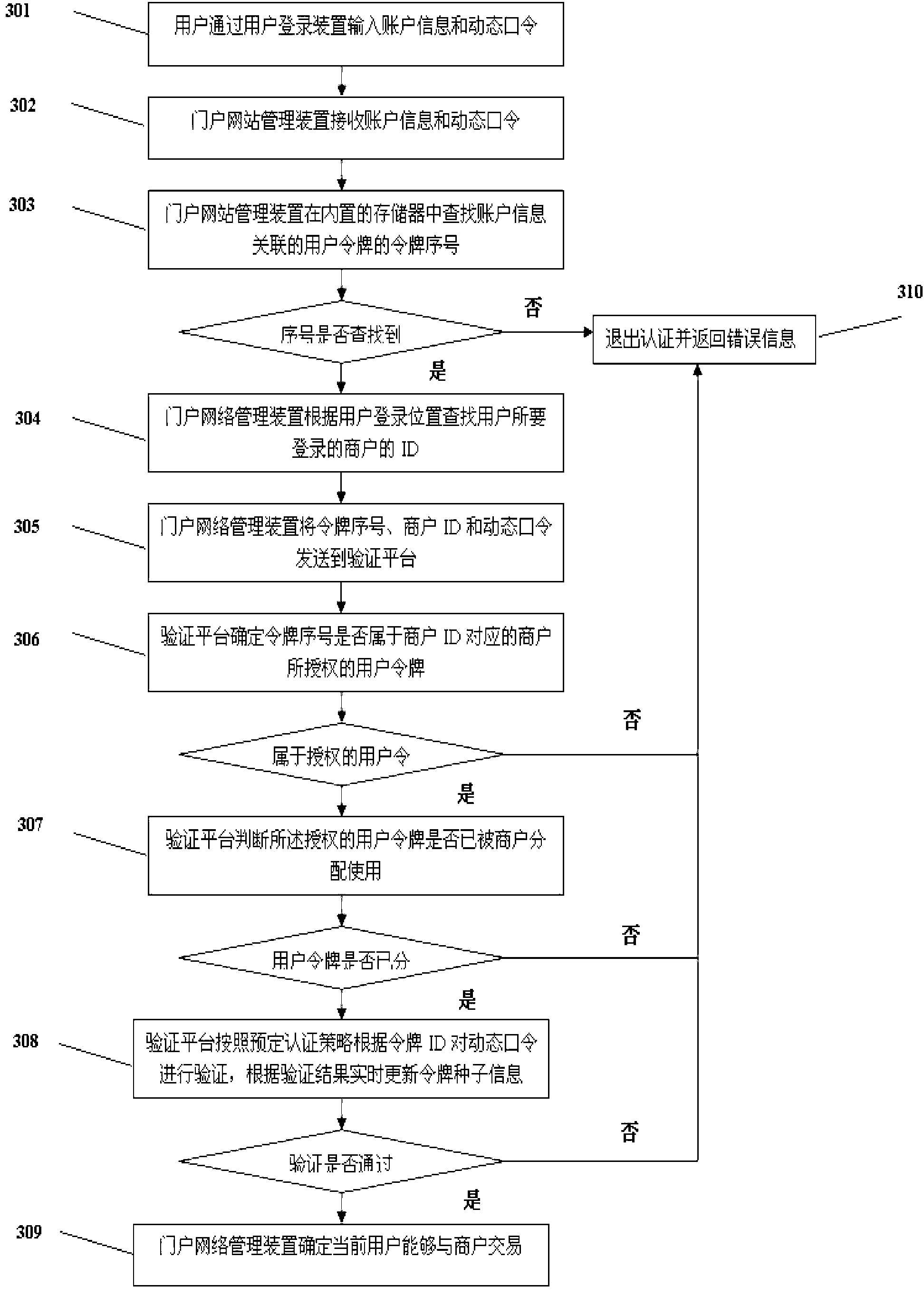

Independent account seamless access dynamic password login system and method

The invention provides an independent account seamless access dynamic password login system and method. The system comprises a user login device, a user token, a user website management device and a verification platform, wherein the user login device is connected with the user website management device, and the user website management device is connected with the verification platform; and the verification platform is connected with the user token. According to the independent account seamless access dynamic password login system and method provided by the invention, the user token and the user account maintenance are arranged at the portal website management device side, thereby avoiding the leakage of client information on a portal website, ensuring the economic interests of a portal website operator, and improving the security of dynamic password login.

Owner:SHANGHAI PEOPLENET SECURITY TECH

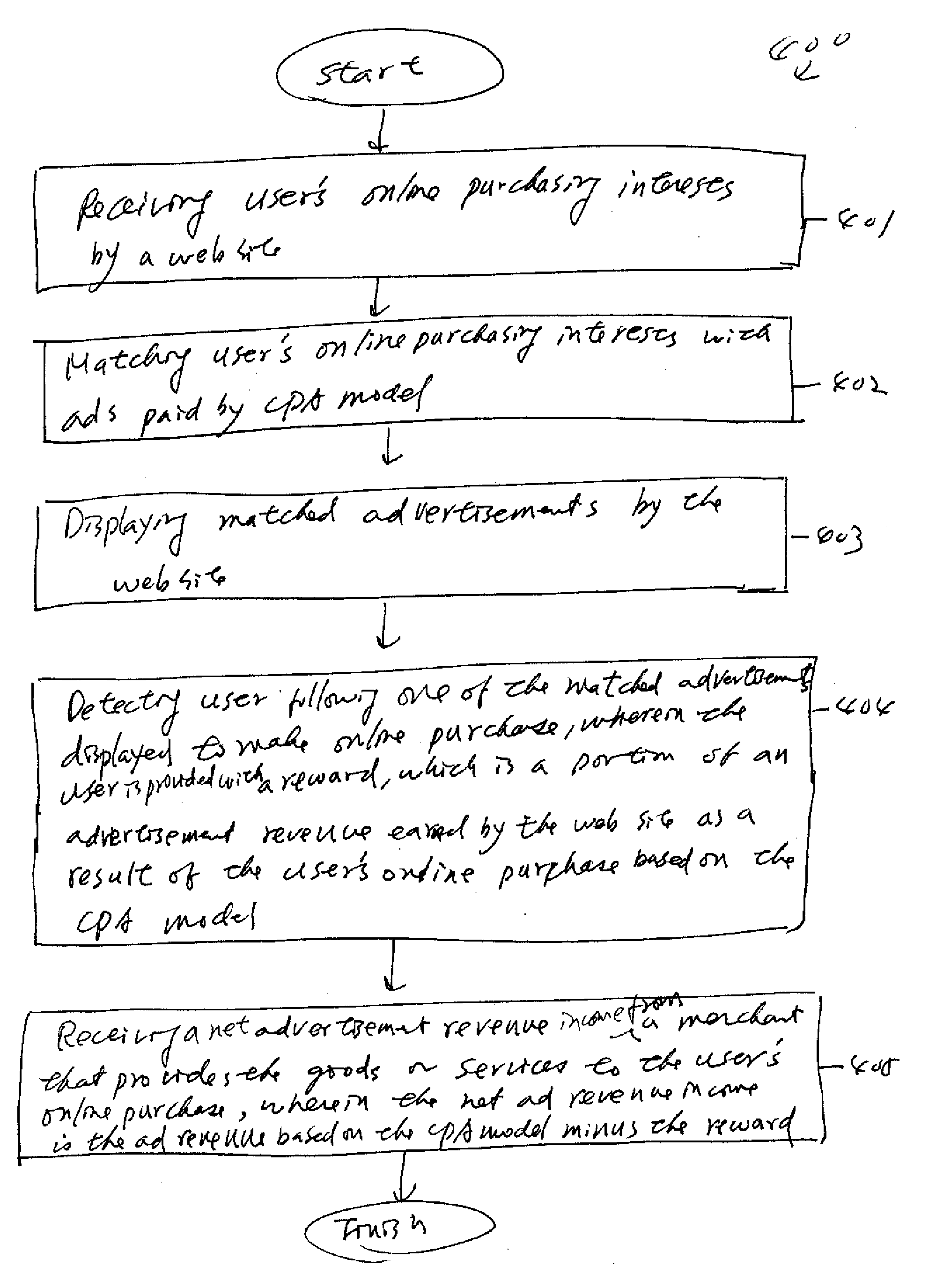

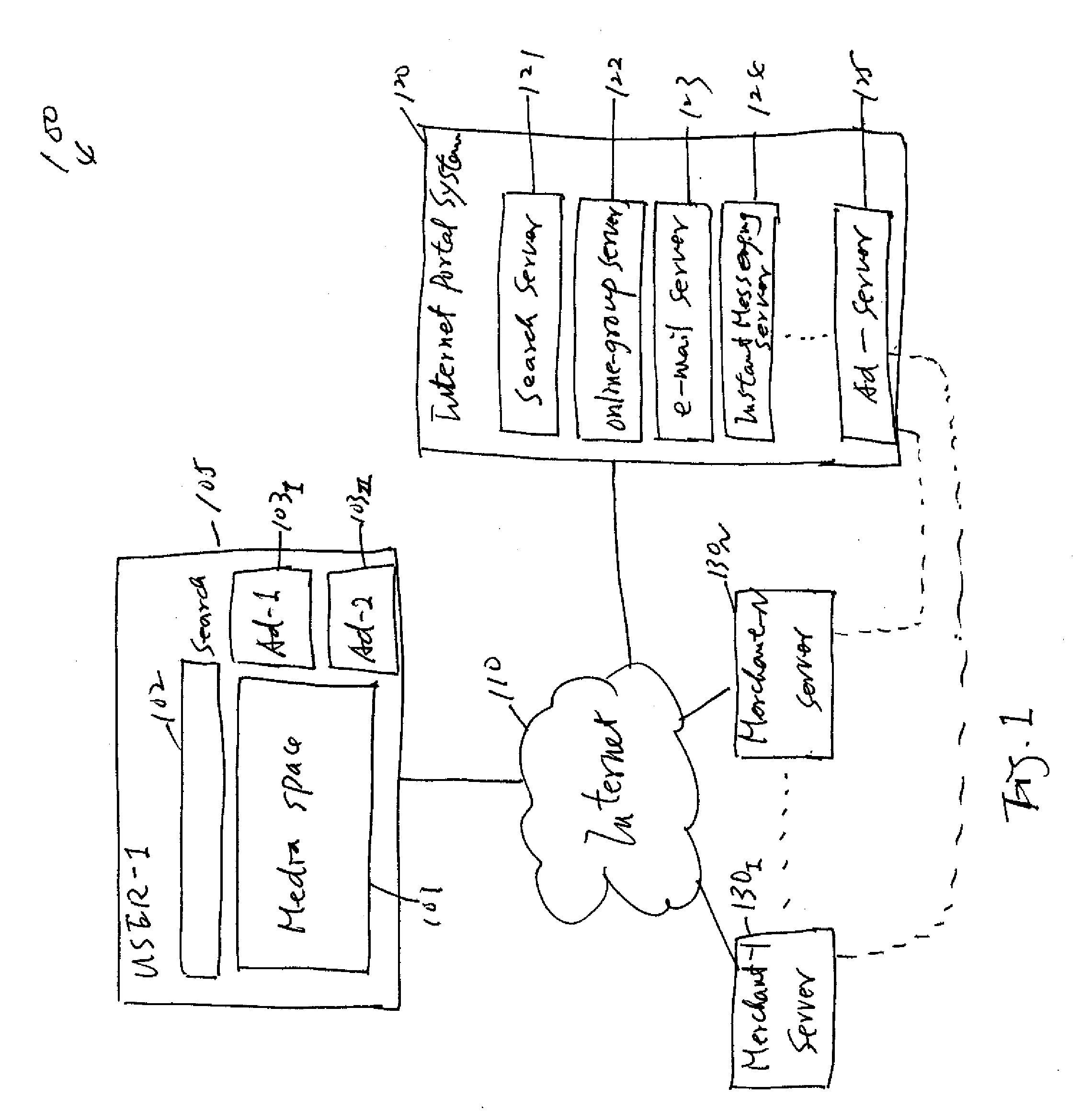

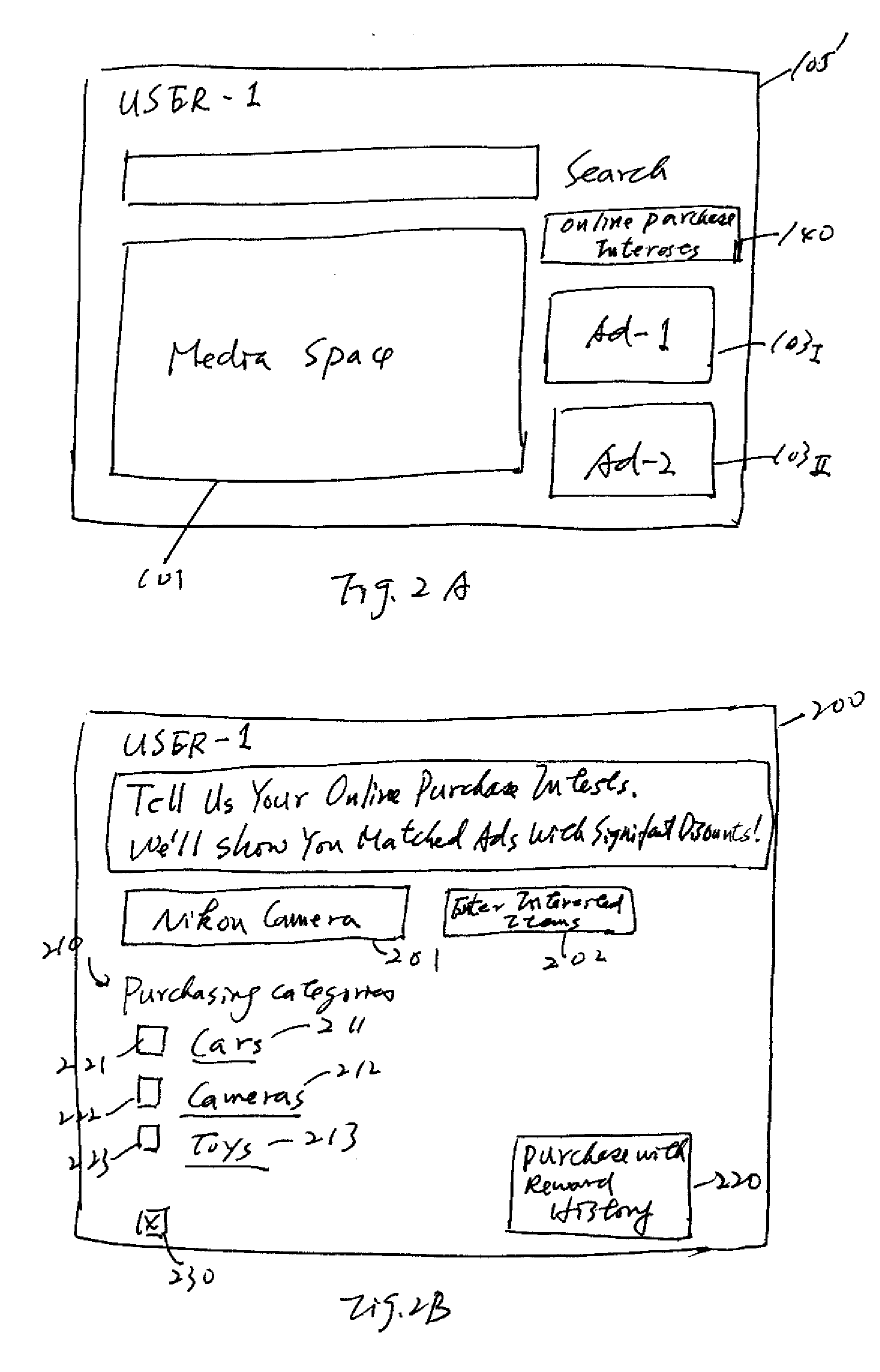

Revenue-sharing to incentivize users to reveal online purchasing interests

The various embodiments of the present invention provide systems and methods to incentivize online users to reveal their online purchasing interests so that advertisements matches their online purchasing interests can be displayed to the users. When users follow the displayed advertisements that match their online purchasing interests to make purchases, users are rewarded by sharing a portion of the advertising (or advertisement) revenue that are related to their online purchases and are collected by the web site(s) that displays the advertisements. The payout for the advertisements by the advertisers to the web site(s) is based on click-per-action (CPA) model, which generally pays more substantially per purchase action. Therefore, the users, who share a portion of the advertisement revenue directly related to their online purchases, can receive more substantial rewards. The reward is mainly monetary (or financial gain) and can come in various forms, such as discount, or credit.

Owner:OATH INC

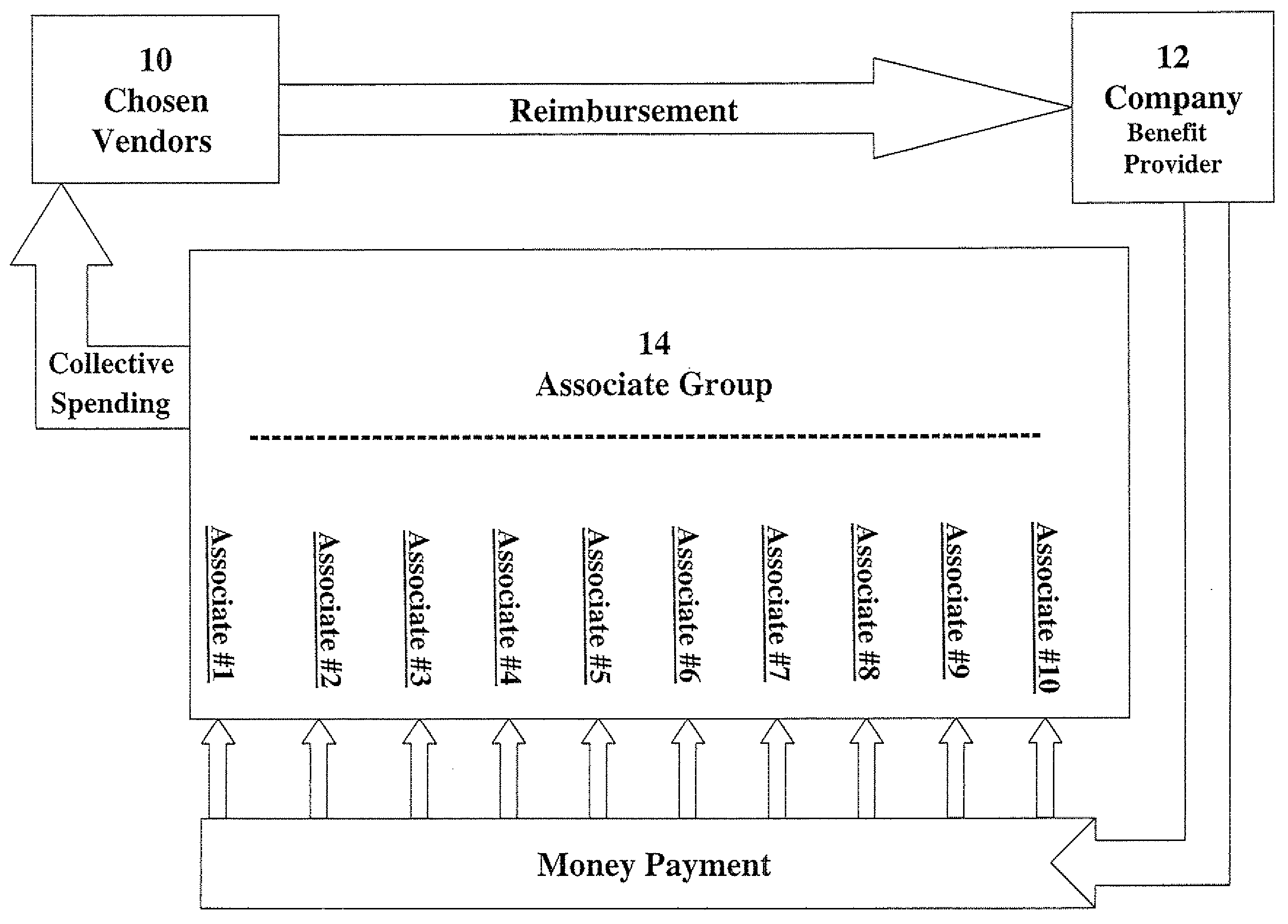

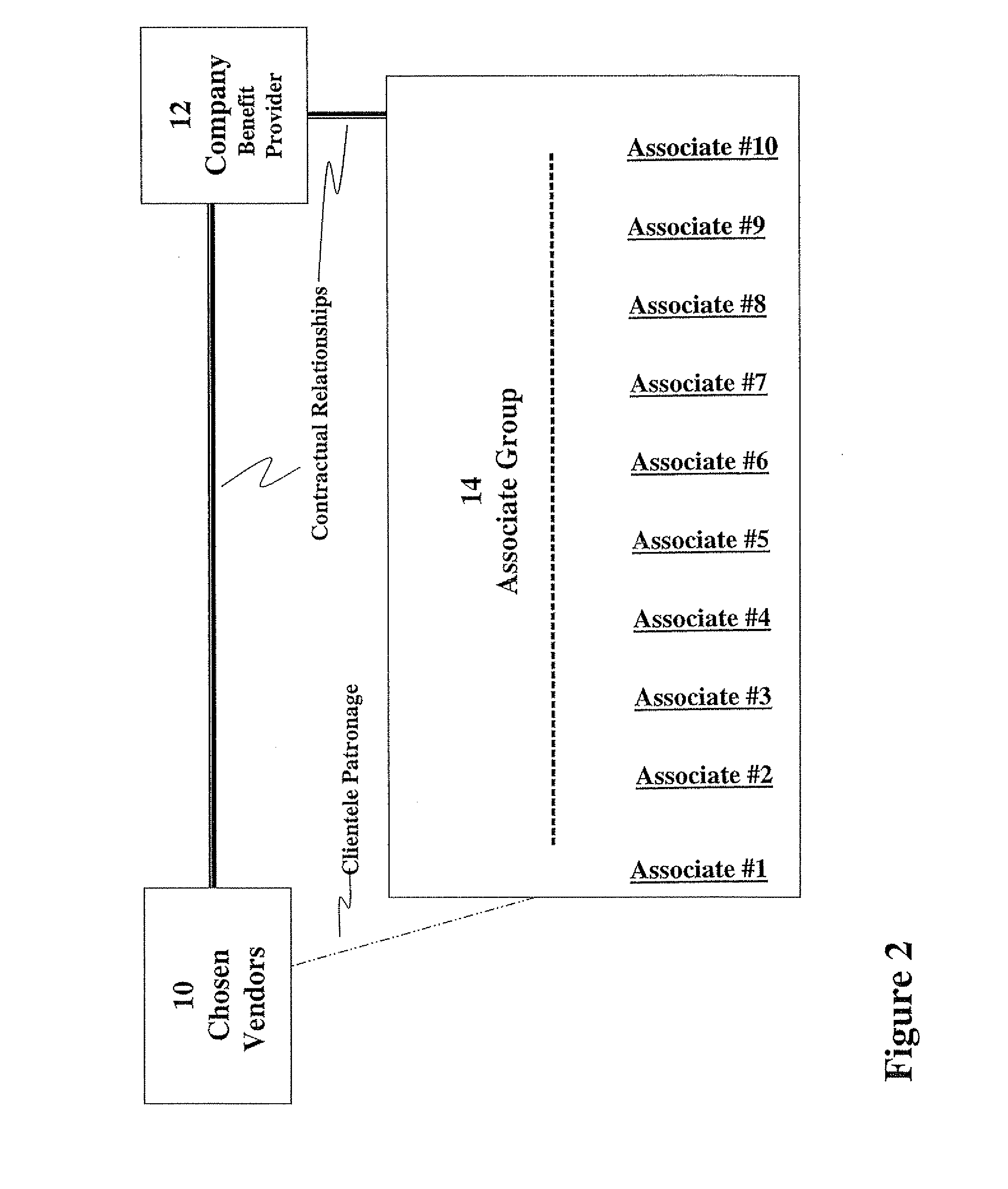

Financial benefits program

A method for providing financial benefits to Company associates buying at vendors chosen by the Company. The first benefit is a money payment to associates by the Company based on the collective spending of all associates at chosen vendors. The second benefit is a money payment by the Company to associate for each referral materializing into an additional association with the Company. The third benefit is an additional money payment to associates by the Company based on a combination of collective associate spending at all chosen vendors and payment recipient down line spending.

Owner:BARGIL YOSSEF

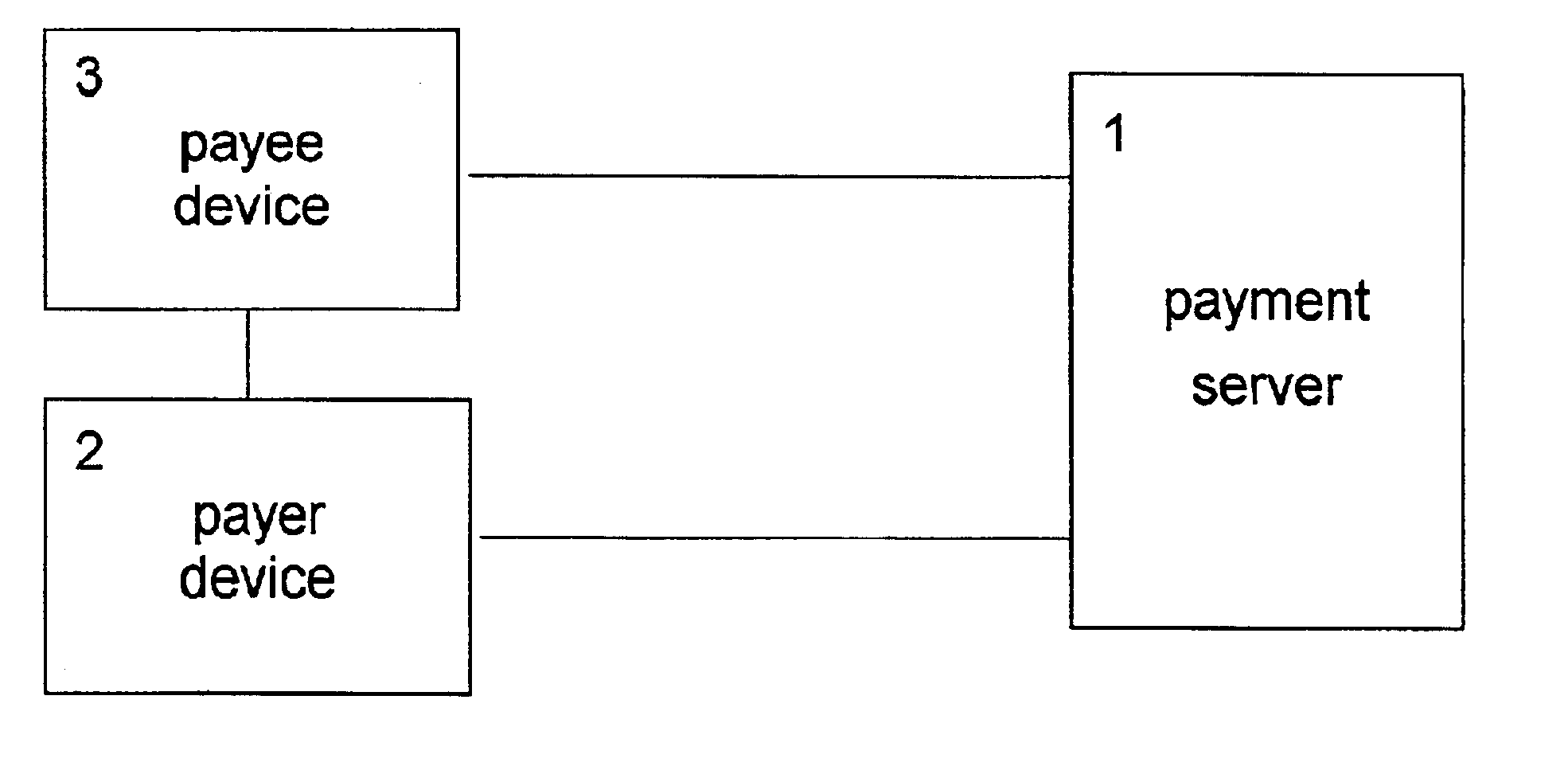

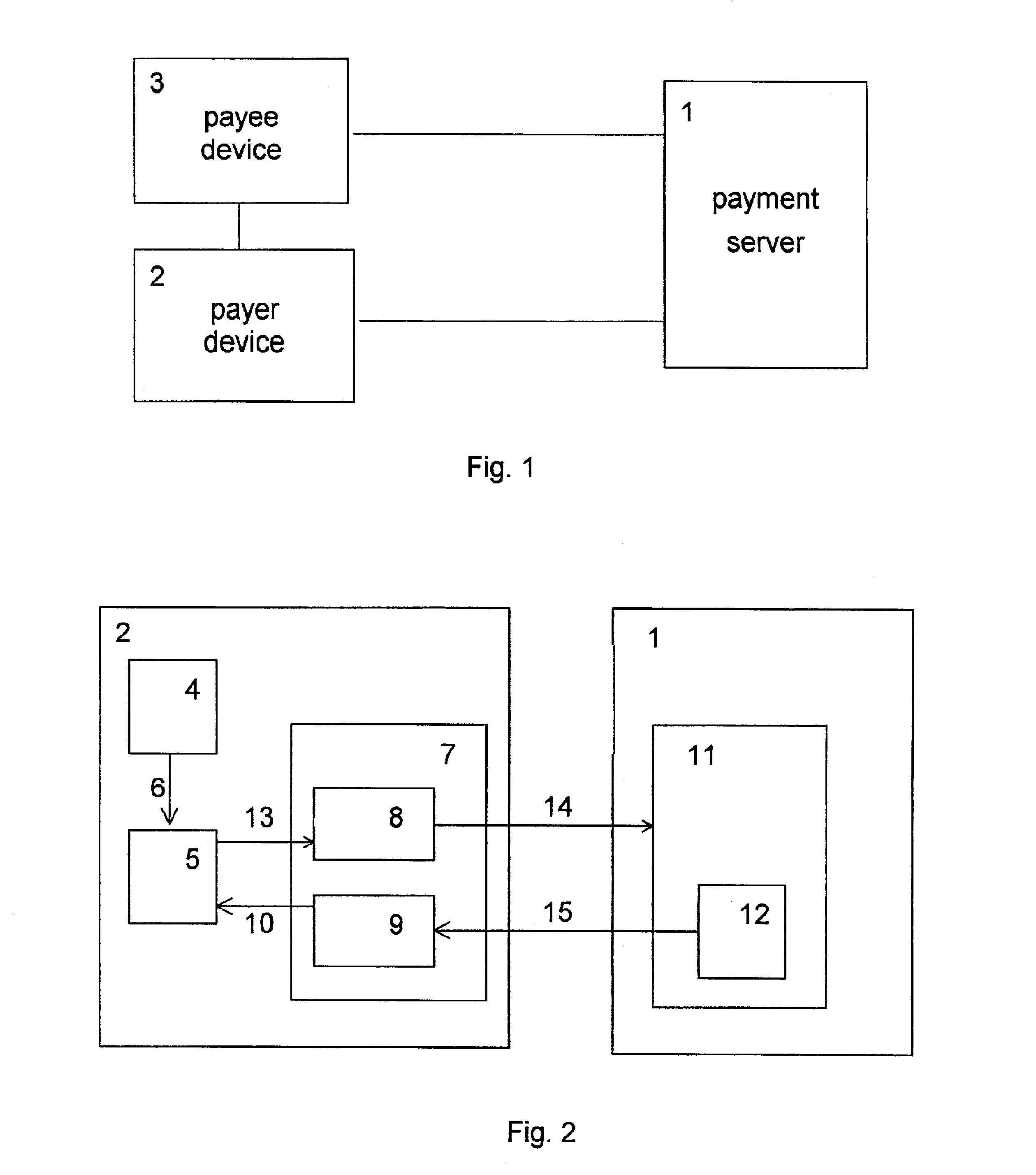

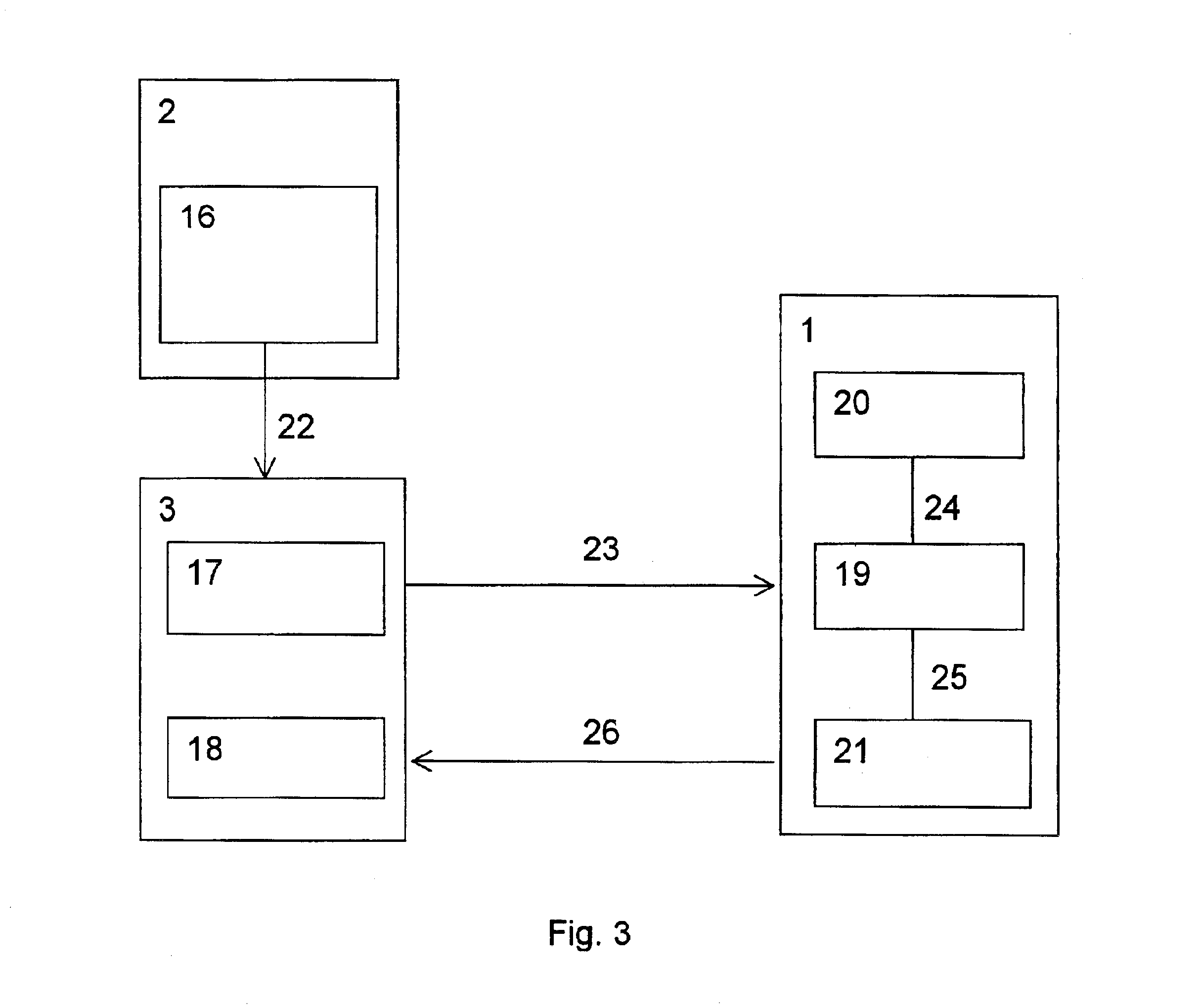

Method for carrying out transactions and device for realizing the same

InactiveUS6859795B1Effective and reliablePrivacy protectionSecret communicationBuying/selling/leasing transactionsBusiness-to-businessNetwork connection

A method for effecting payments is suggested which allows protecting the financial interests of each participant of a payment during payments via open telecommunication nets from other participants' cheating, provides protection of the payers' and payees' privacy, admits payments ranging from micro-payments to business-to-business payments, ensures that the time taken to effecting a payment depends only on the speed of action of the net connections and not on the payment amount, makes it possible to serve of serving a number of clients which grows proportionally to the payment system operators resources, is easy to build into an arbitrary trade system, enables each client both to pay and to receive payments, and makes possible payments between clients of different banks. The method of effecting payments is realized with the help of programming means.

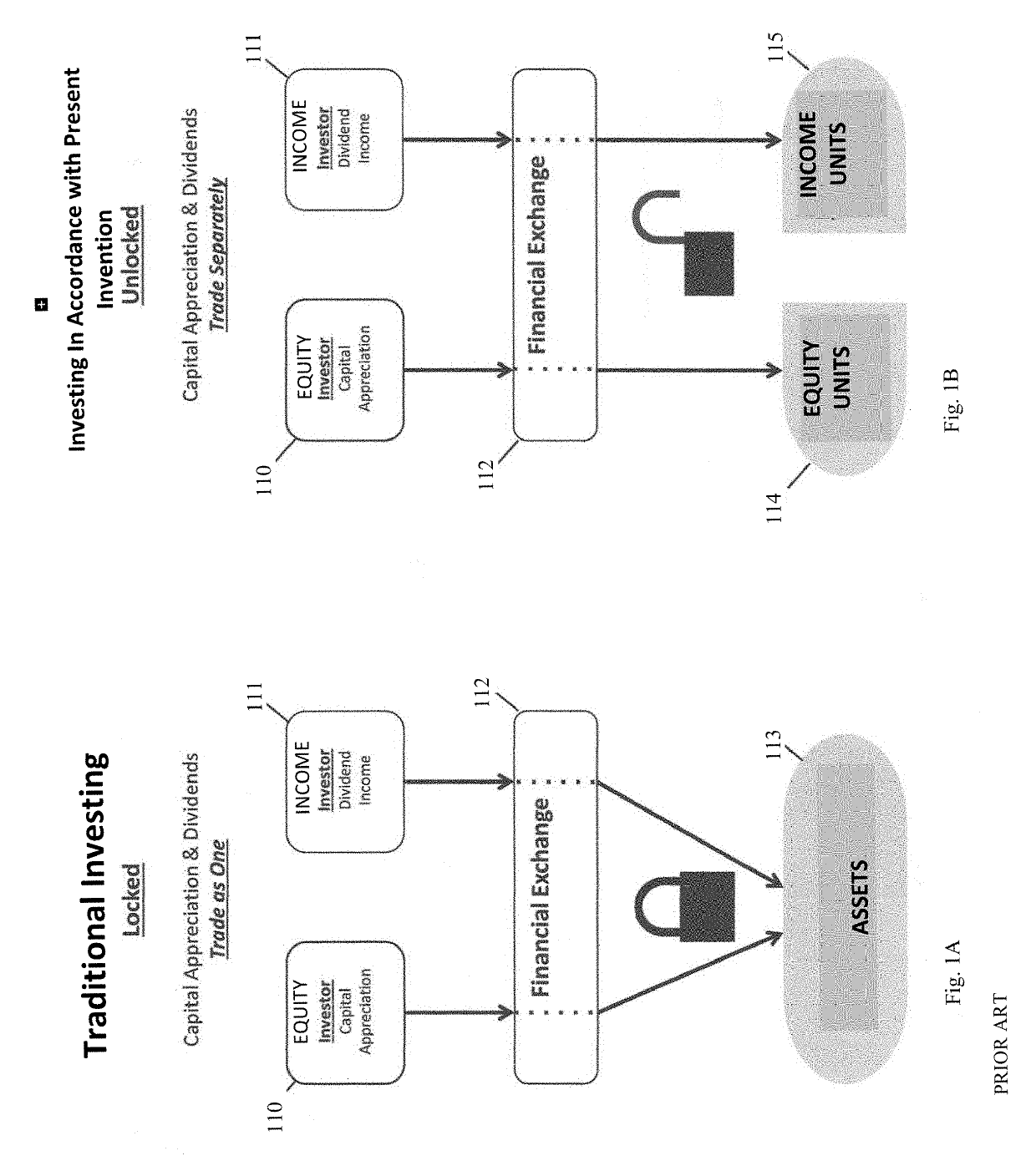

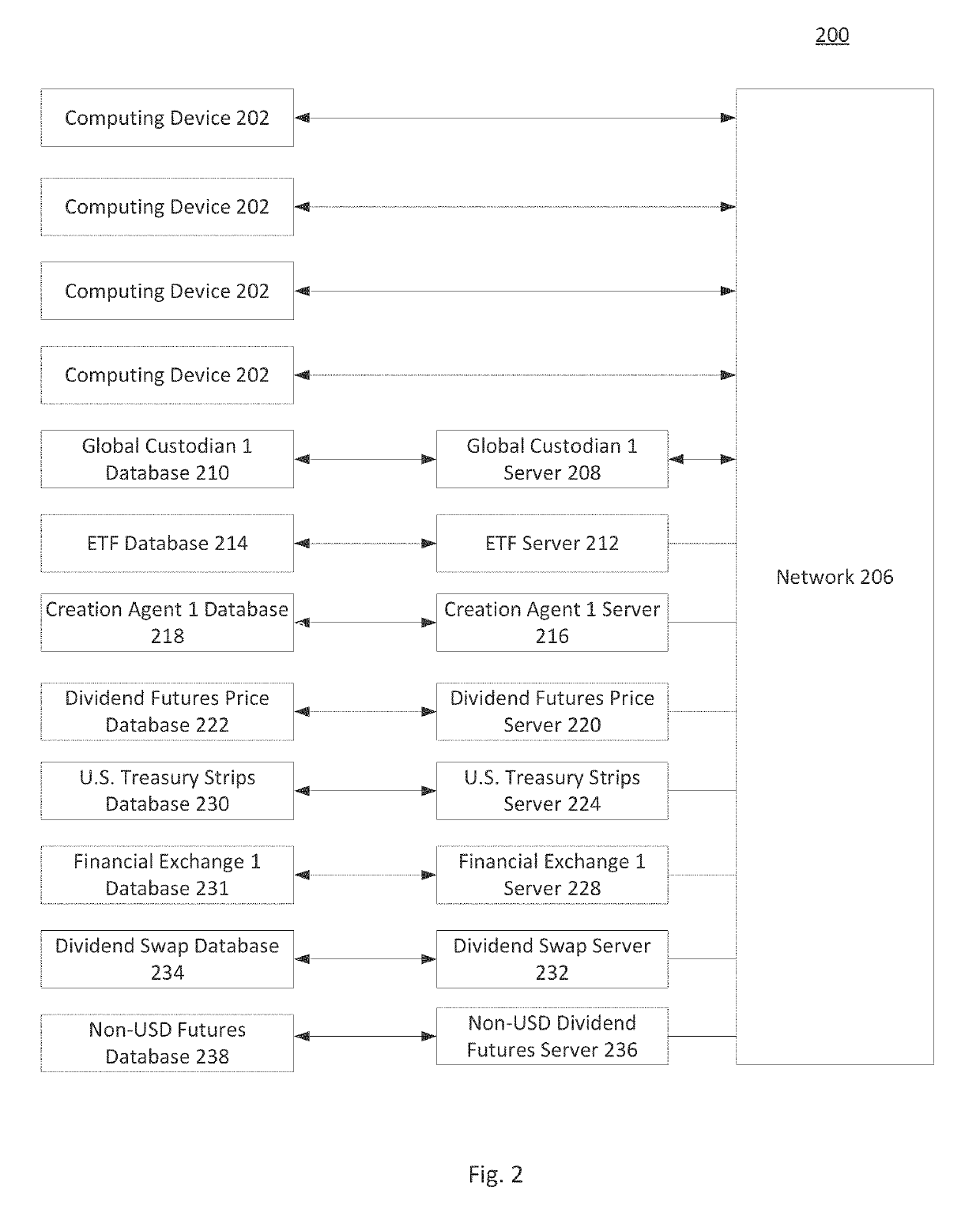

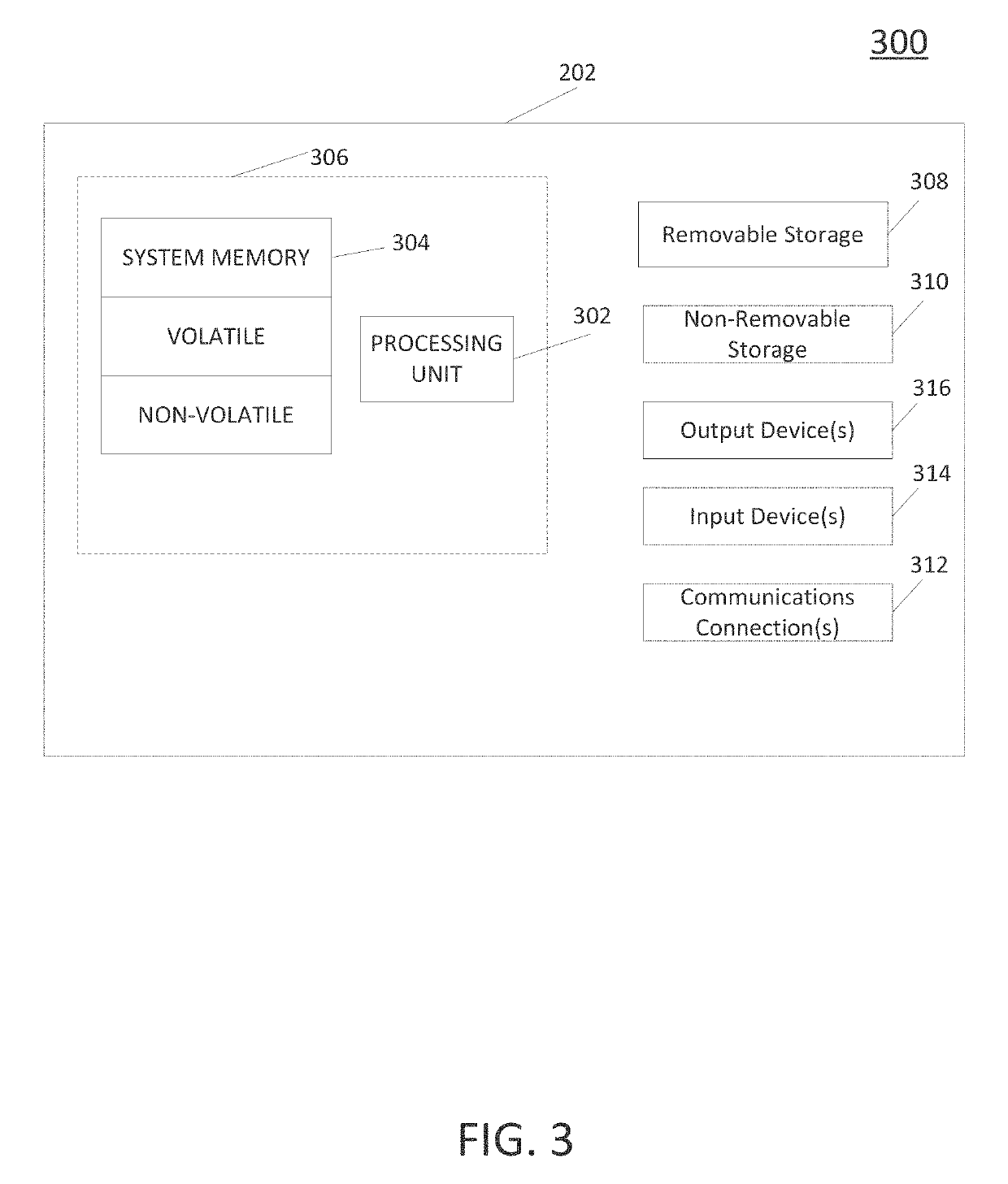

Separately traded registered discount income and equity securities and systems and methods for trading thereof

Systems and methods for creating different financial interests in a portfolio of stocks, a stock index or other financial assets based on a series of interim cash flows of the asset. Specifically, the present invention relates to systems and methods for dividing such assets into income and equity components. In one aspect, the income component is an ordinary dividend component for a fixed time period or until a fixed dollar amount has been paid and the equity component is a capital component that can be traded separately.

Owner:METAURUS LLC

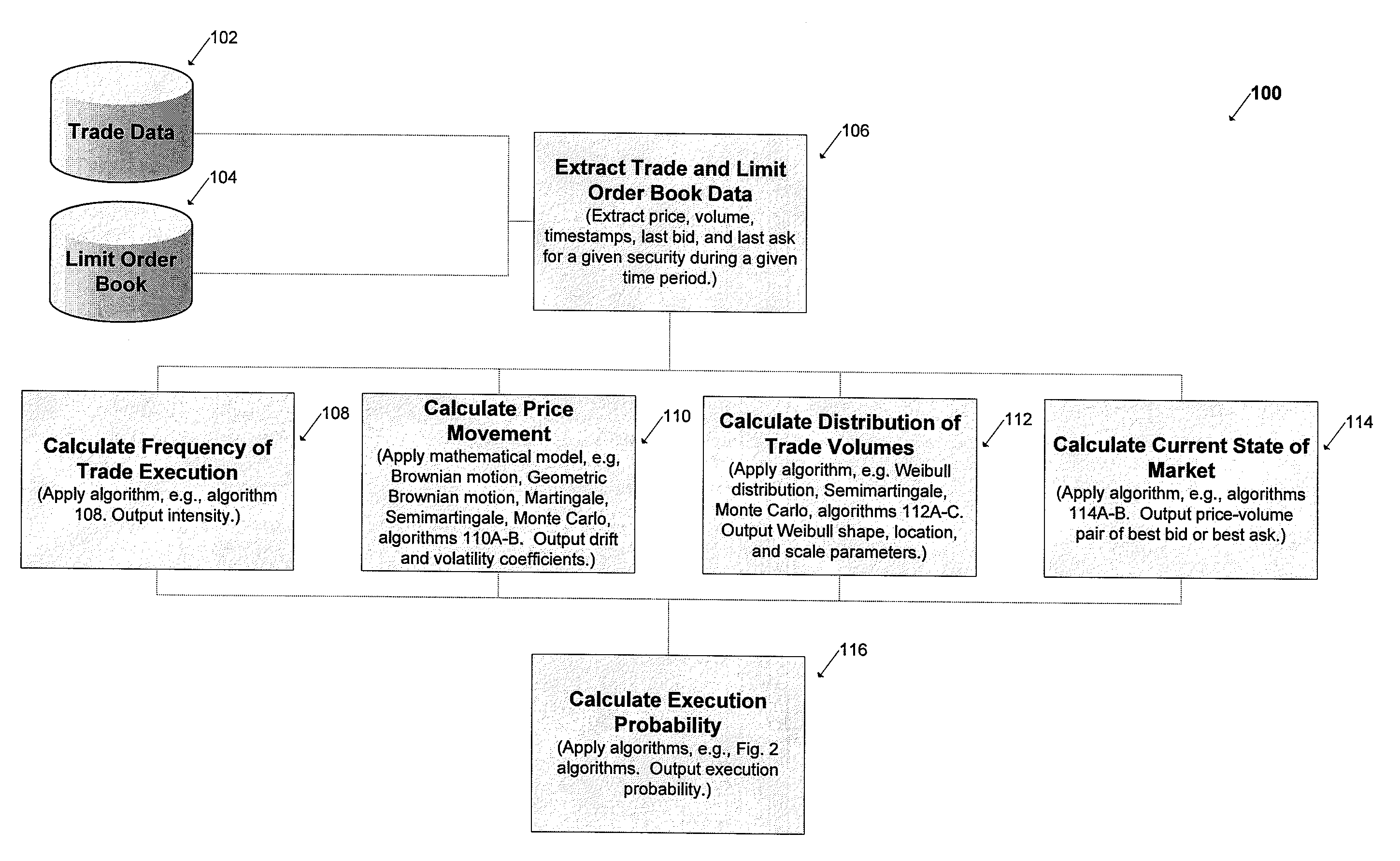

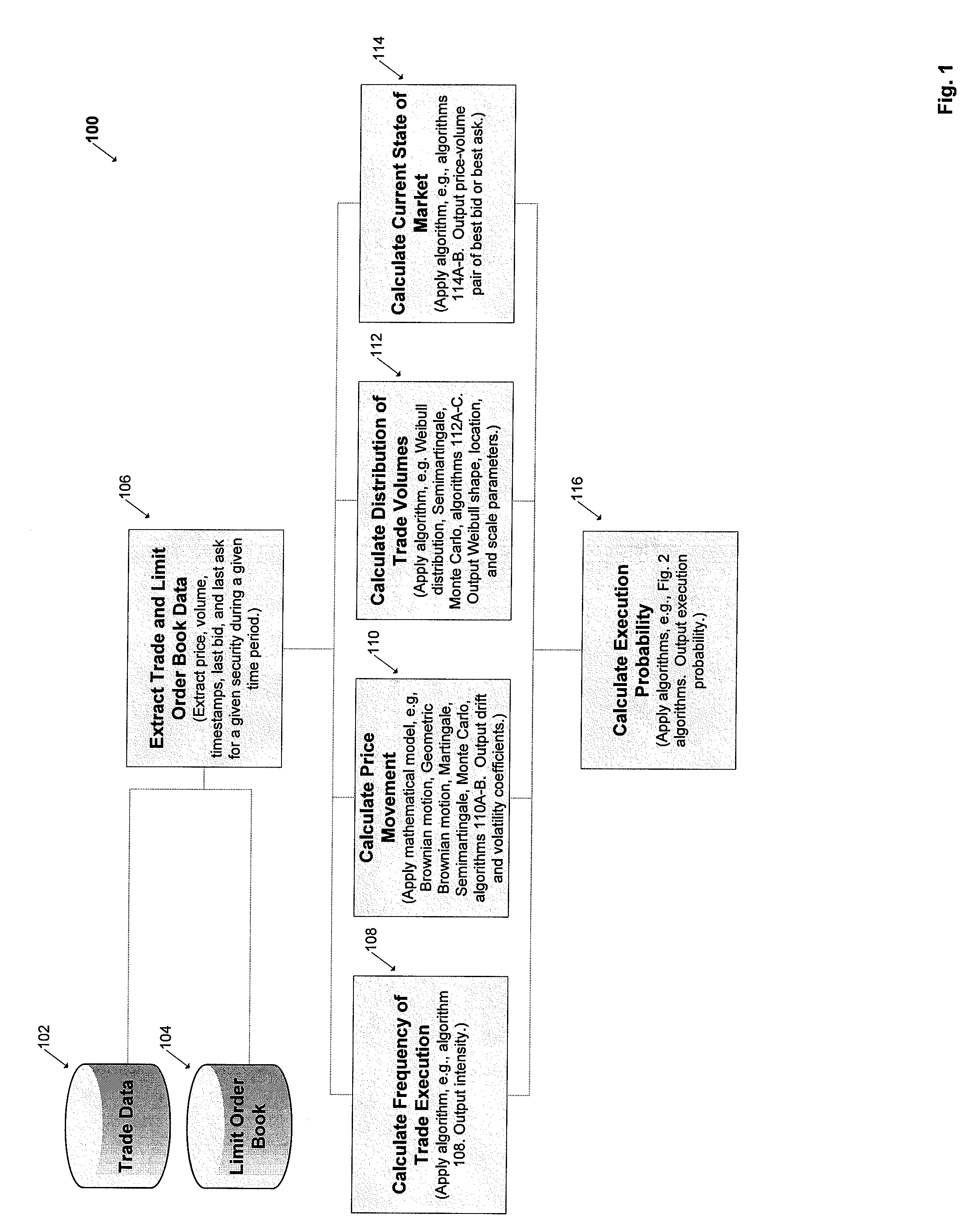

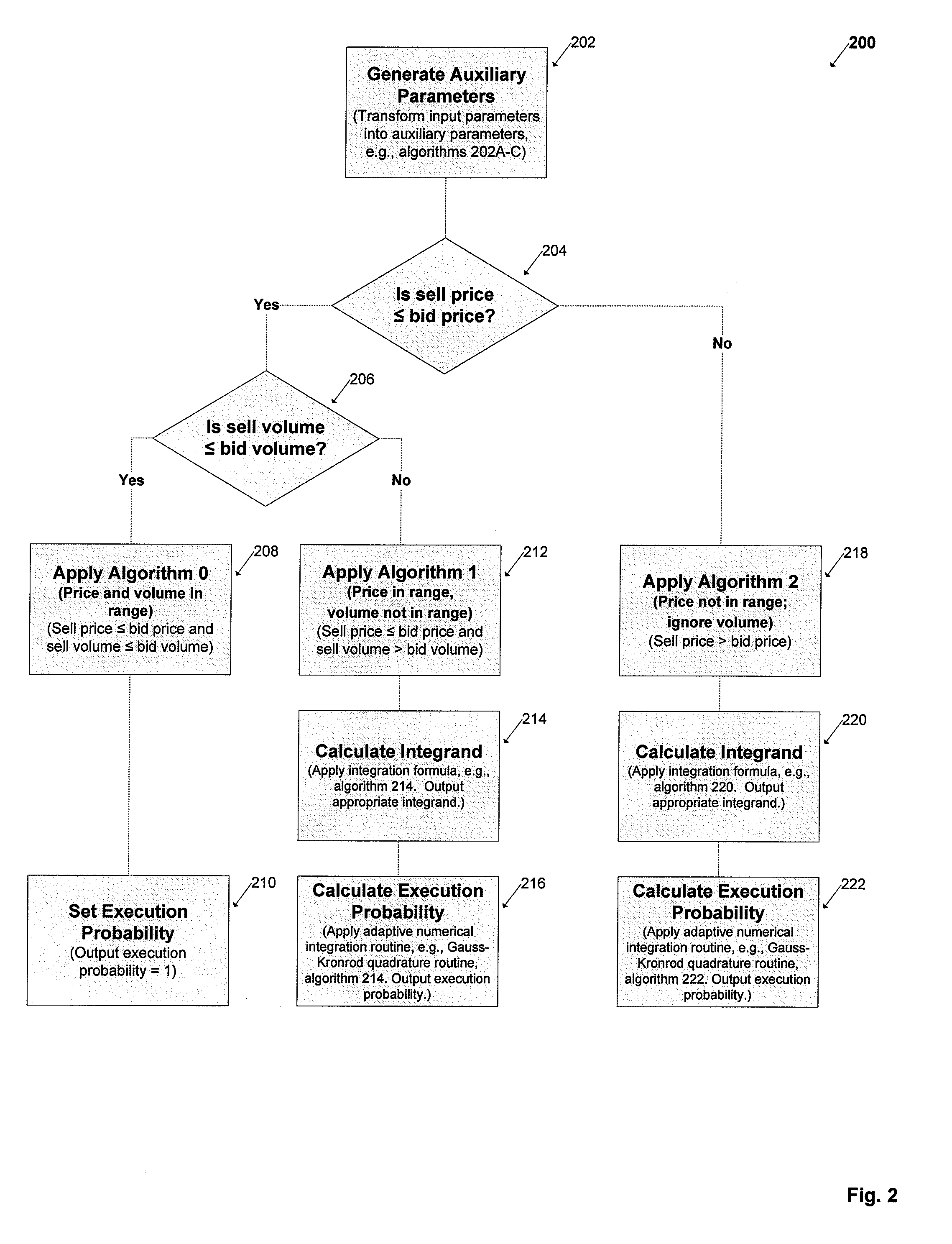

System and method for providing the execution probability of a limit order

Owner:BLOOMBER FINANCE LP

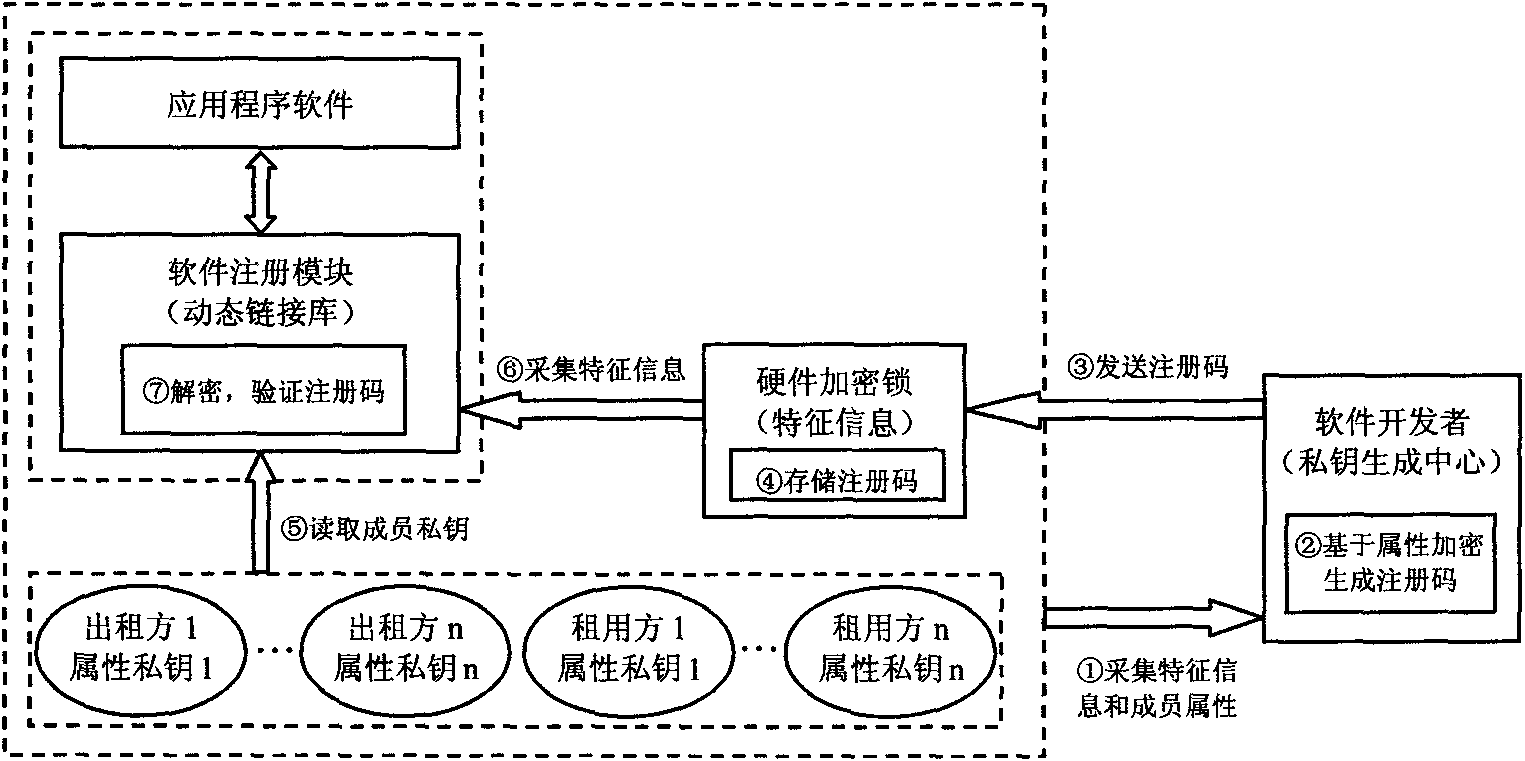

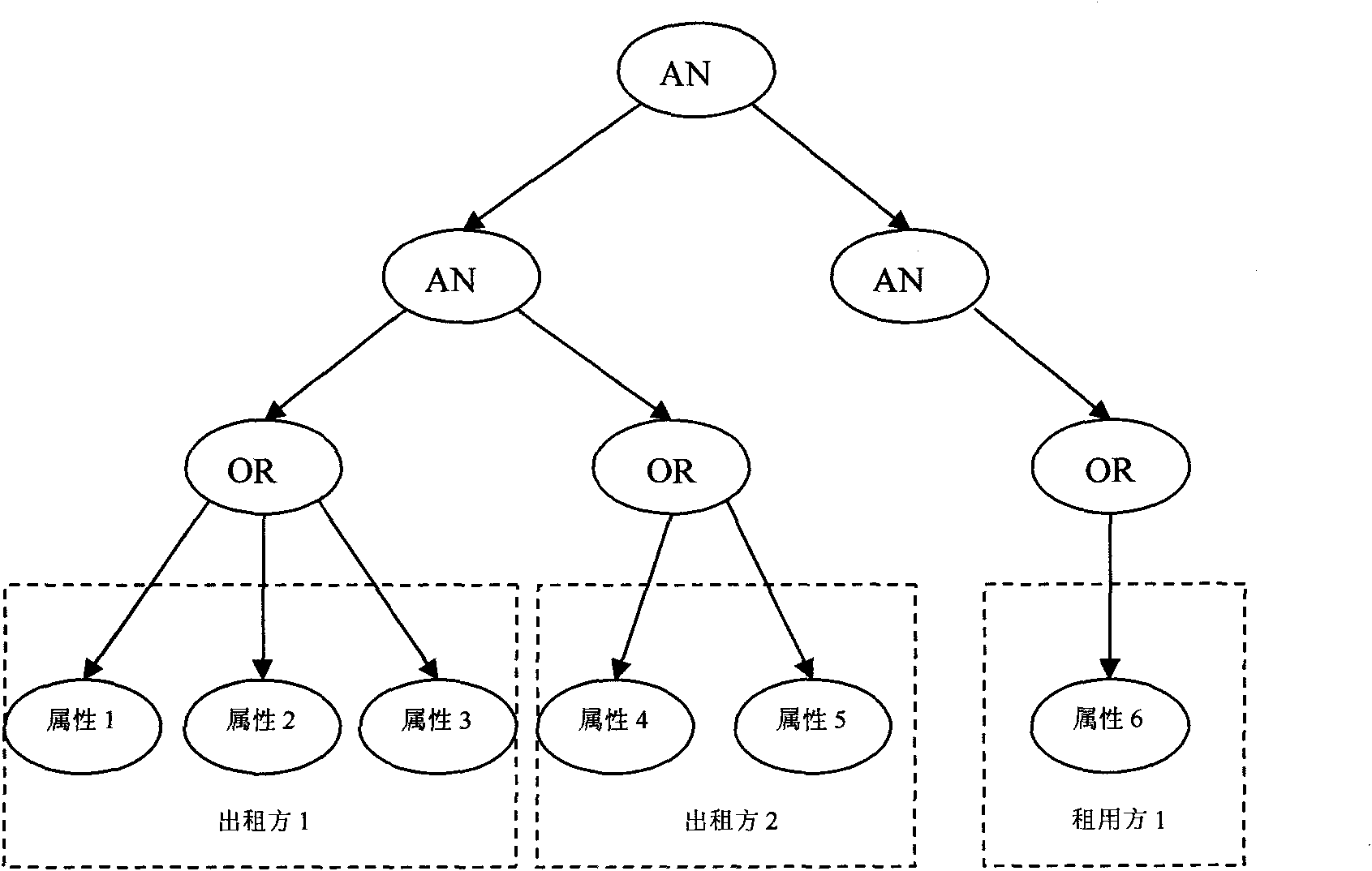

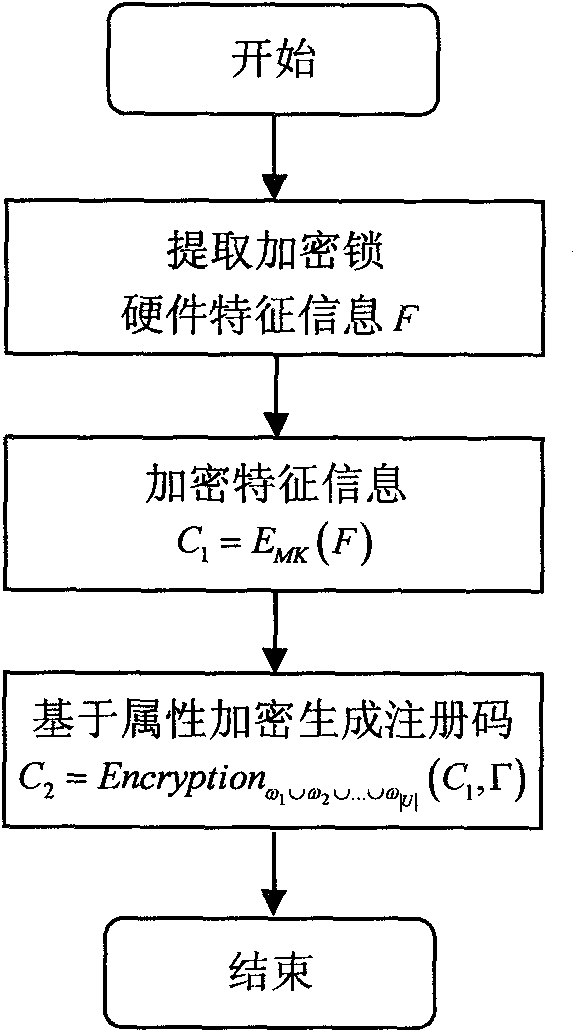

Software lease authorization method based on attribute encryption

InactiveCN102810141ARealize multi-party joint authorizationTroubleshoot authorization issuesComputer security arrangementsAttribute-based encryptionSoftware engineering

The invention relates to software security protection problems in the software lease industry, in particular to multi-party joint authorization and access control of the leased software under the condition that multi-party economic benefits are related. According to the invention, 'many-to-one' and 'many-to-many' software lease business modes consisting of a plurality of leasers and one or more leasers are considered, a public key cryptosystem based on the attribute encryption is applied to the software security protection, a multi-party joint software authorization method based on the attribute encryption is provided, and software authorization and access control in the software lease process are realized. Registration codes are generated by employing a dual encryption strategy, hardware encryption lock equipment is combined to realize the multi-party joint software authorization, and a flexible and complex authorization rule is supported; and moreover, the actual requirements of software leasing business under circumstances of complex leasing process, diversified service restriction forms and involvement of multi-party benefit division can be well met.

Owner:HARBIN CONCORD ISLAND DIGITAL SCI & TECH

Methods, systems, and computer program products for managing organized binary advertising asset markets

Binary advertising markets are developed where personalized media such as digital and even analog advertising is delivered to and accessed by audience members enabling advertisers to buy advertising for broadcast to televisions, smartphones and other types of digital devices. The market is designed to provide participants a new way to have their orders entered, matched, executed, and settled, to manage and monitor risk characteristics of their content placement or advertising placement transactions, and any rights and positions that result from those transactions. Standardized units of exchange represented by profile access rights and display space access rights appropriately designed for their respective markets are used in both primary direct and secondary alternative markets. Processes are also implemented where an audience member receives economic benefit in exchange for confirming view of or rating an advertisement, or viewing advertisements while logged in.

Owner:MANAGED AUDIENCE SHARE SOLUTIONS

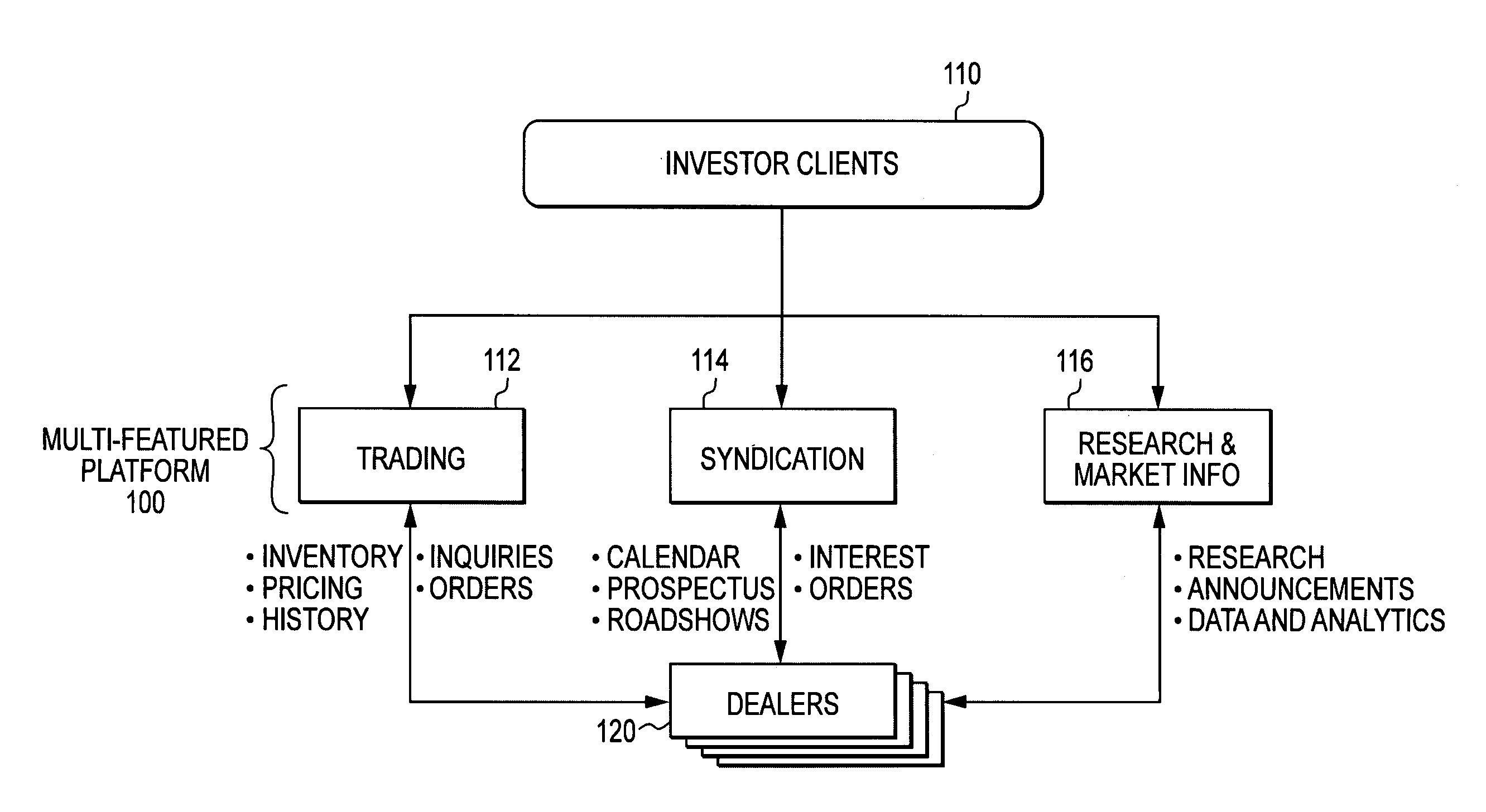

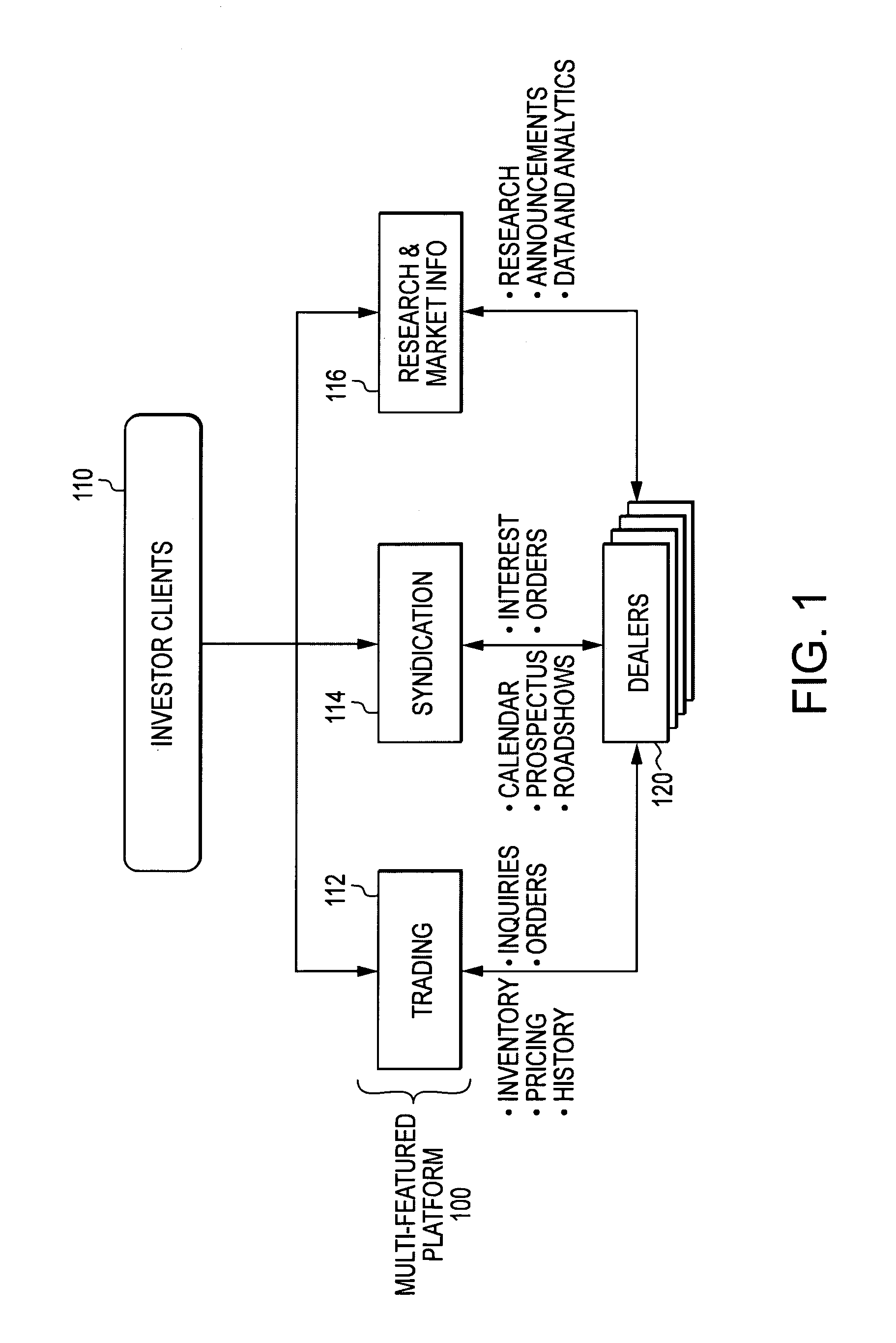

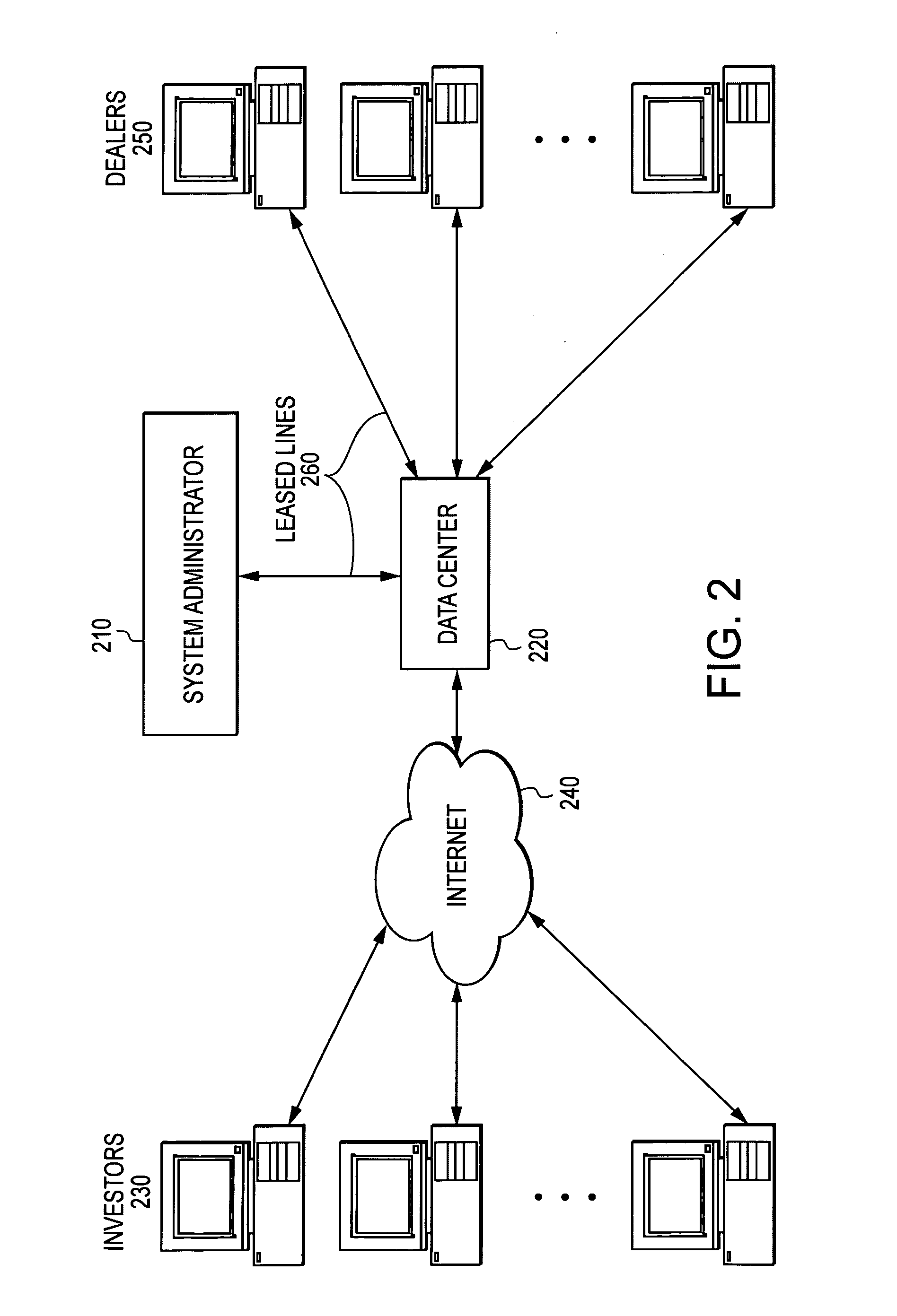

Electronic inquiry lists for financial products

InactiveUS7499883B2Improve efficiencyReduce the amount requiredFinanceEngineeringFinancial transaction

Inquiry lists for financial interests are submitted, negotiated and traded between investors and dealers over a network or networks. An investor interface for display is provided to an investor. A dealer interface for display is provided to a plurality of dealers. The investor can create an inquiry list via the investor interface containing a plurality of inquiries for a corresponding plurality of different financial interests and can send a message containing the inquiry list to selected dealer(s) where an established relationship exists between said investor and dealers. The dealer(s) can provide respective responses to the message, the response containing respective offers / bids on the plurality of inquiries contained in the inquiry list via the dealer interface. The respective offers / bids are displayed in the inquiry list on the investor interface. The investor may then select one of the respective dealer offers / bids for each inquiry list line item via the investor interface.

Owner:MARKETAXESS HLDG

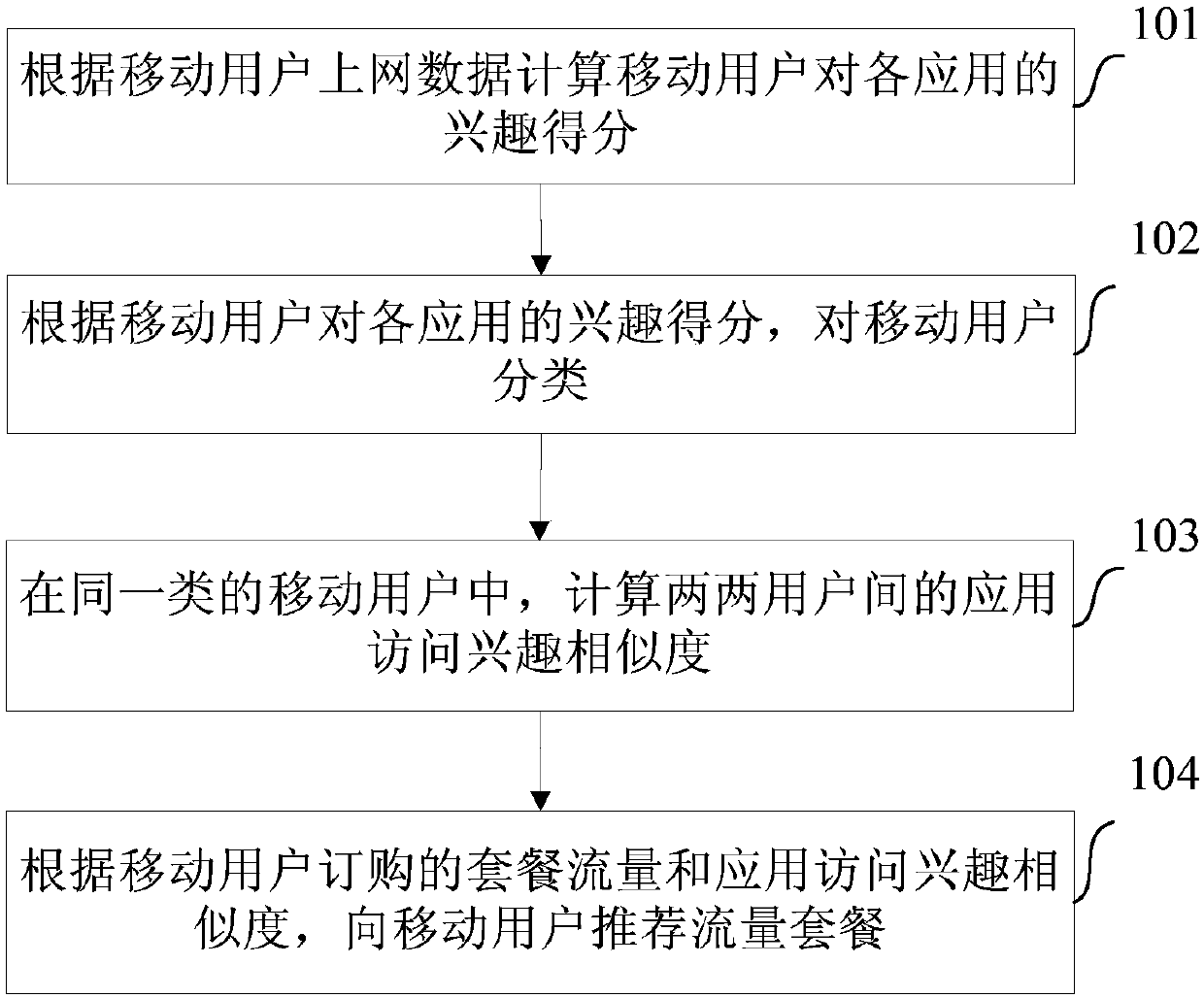

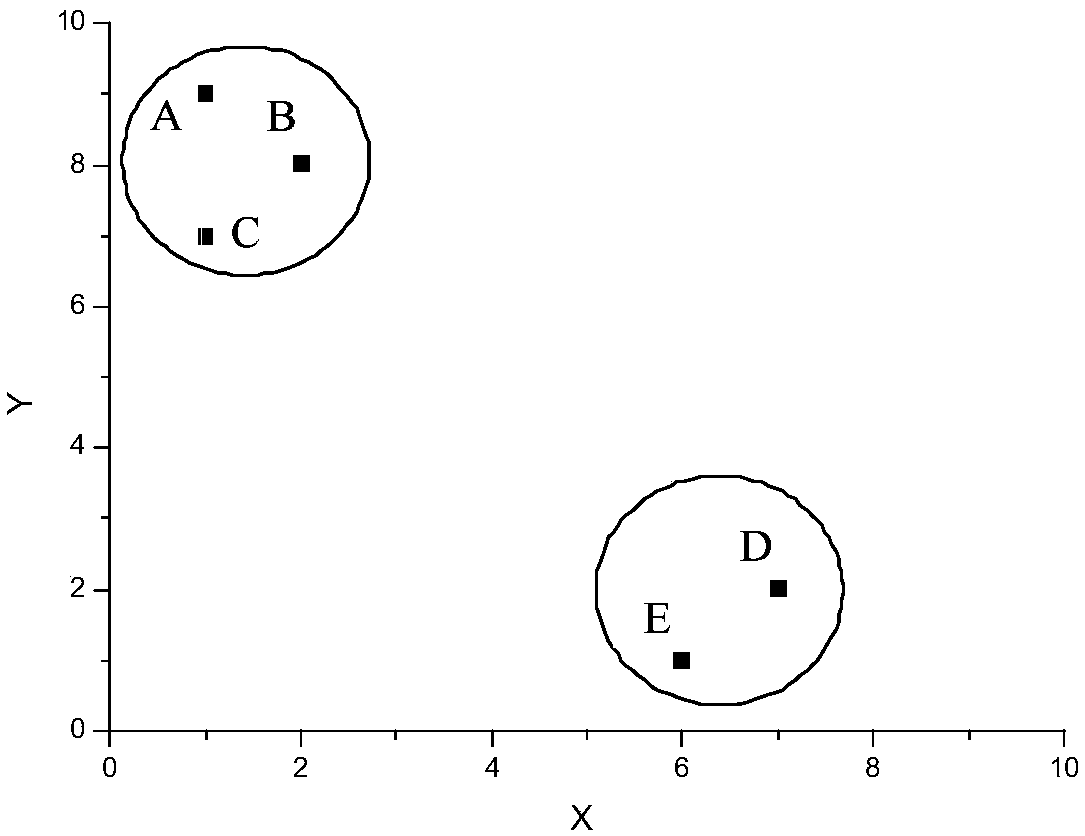

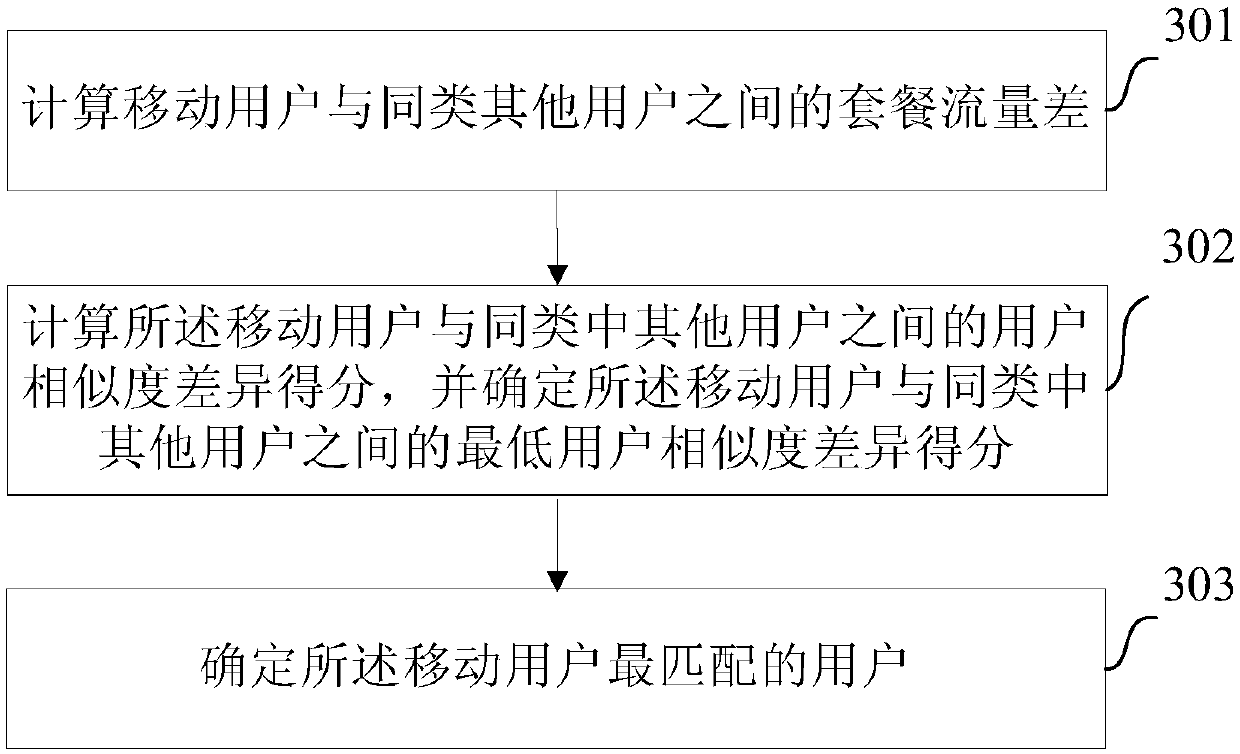

Data plan recommendation method and device based on Internet-surfing behaviors of mobile users

ActiveCN107896153APrecise pushMeet actual needsMetering/charging/biilling arrangementsAccounting/billing servicesThe InternetEconomic benefits

The invention provides a data plan recommendation method and device based on Internet-surfing behaviors of mobile users. The method and device has the advantages that massive data of Internet-surfingbehaviors of the users is analyzed, and the mobile users are classified through application interest scores of the mobile users, so that the users with similar application access interests are classified as users of a same type; and a data plan subscribed by the user among the users of the same type, whose application access interests are the closest to the application access interests of the userto whom a data plan is to be recommended and whose subscription capability is similar to the subscription capability of the user to whom the data plan is to be recommended, is used as a reference basis for data plan recommendation, that is, the users with the similar application access interests and the similar subscription capabilities are associated, so that precise data plan pushing can be achieved; and the data plan recommended to the user is obtained through analysis based on the big data of the Internet-surfing behaviors of the users, so that actual user requirements can be satisfied, the data plan upgrade success rate for the mobile users can be effectively improved, and tangible economic benefits can be brought to operators.

Owner:CHINA UNITED NETWORK COMM GRP CO LTD

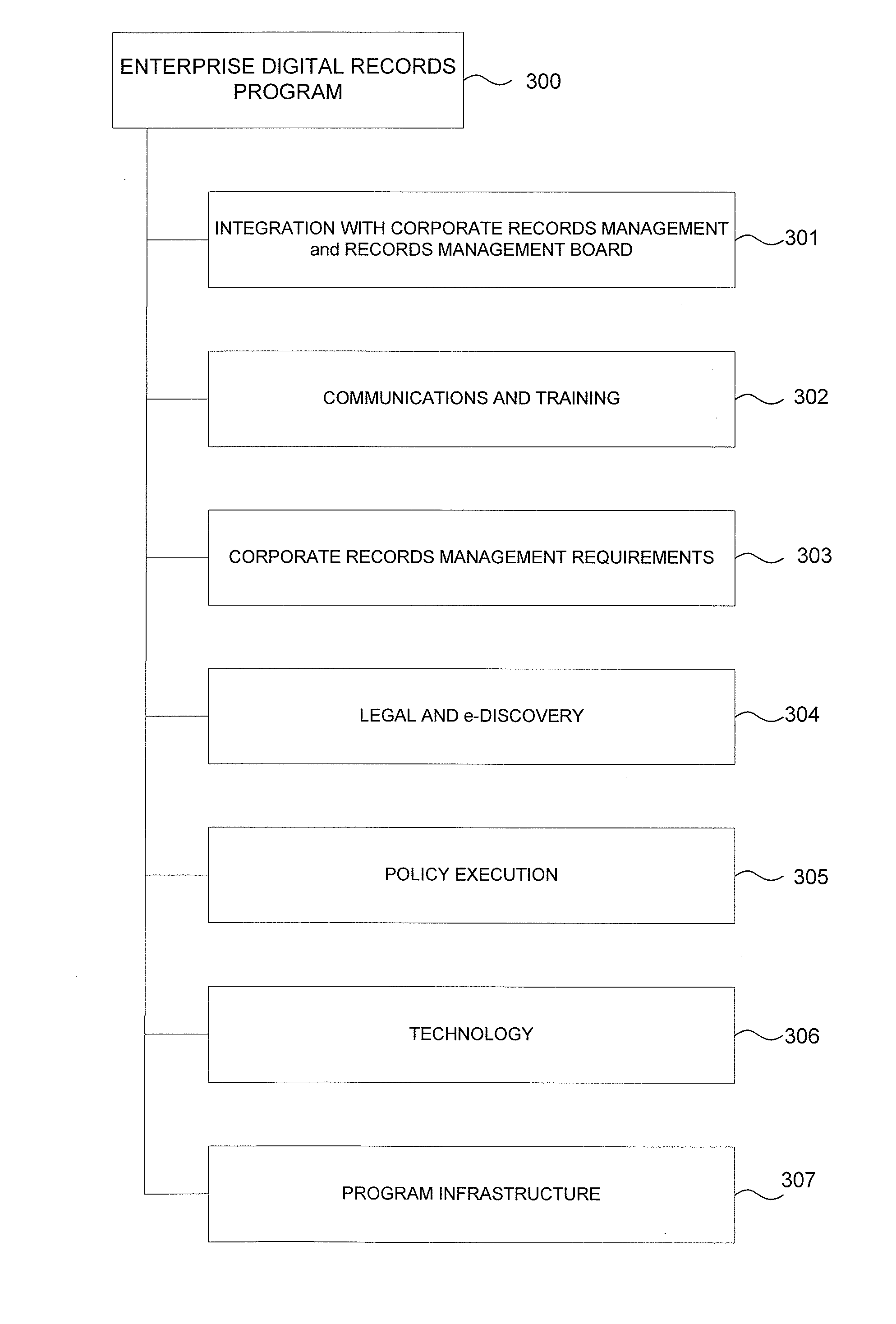

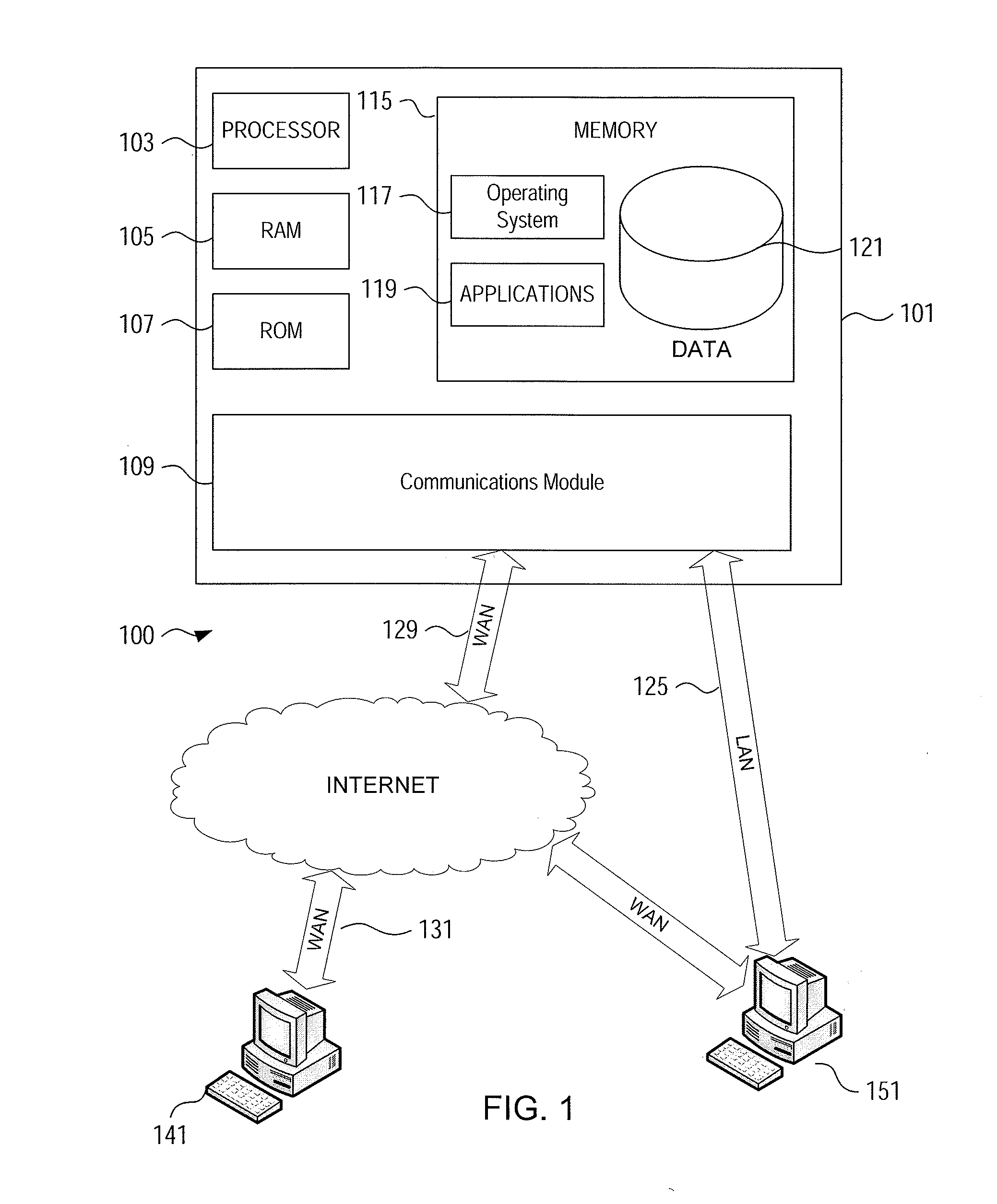

Digital Records Management

InactiveUS20110191145A1Low costNegative environmental impactCommerceSpecial data processing applicationsDocumentation procedureDigital recording

Record management of a business unit is aligned to a digital records policy of a business enterprise. The digital records policy may require process, technology and cultural changes to shift from paper to digital records management. Paper intensive processes tend to have a number of economic, environmental, and operational disadvantages. In addition, government regulations are increasingly requiring businesses to be able to locate and retrieve information quickly. An implementation document contains information about a business process so that a business process supporting digital records may be compared with a digital records policy of the business enterprise. If there are any gaps between the business process and the digital records policy, an action plan may be constructed in order to eliminate or mitigate the gaps. Also, the economic benefits for a business unit migrating to digital records may be analyzed by a business case wizard tool.

Owner:BANK OF AMERICA CORP

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com