Patents

Literature

374results about "Coin/check-freed systems" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

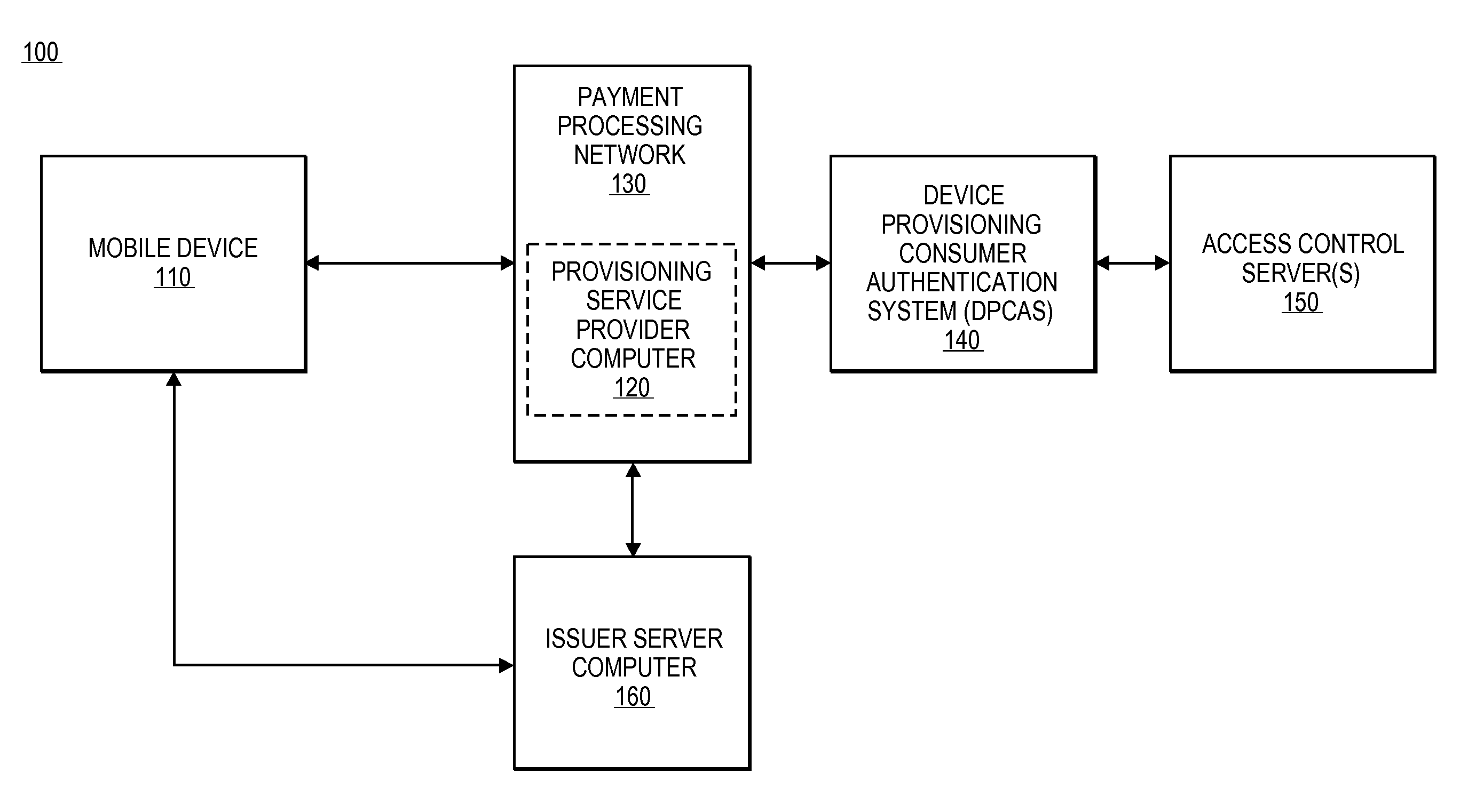

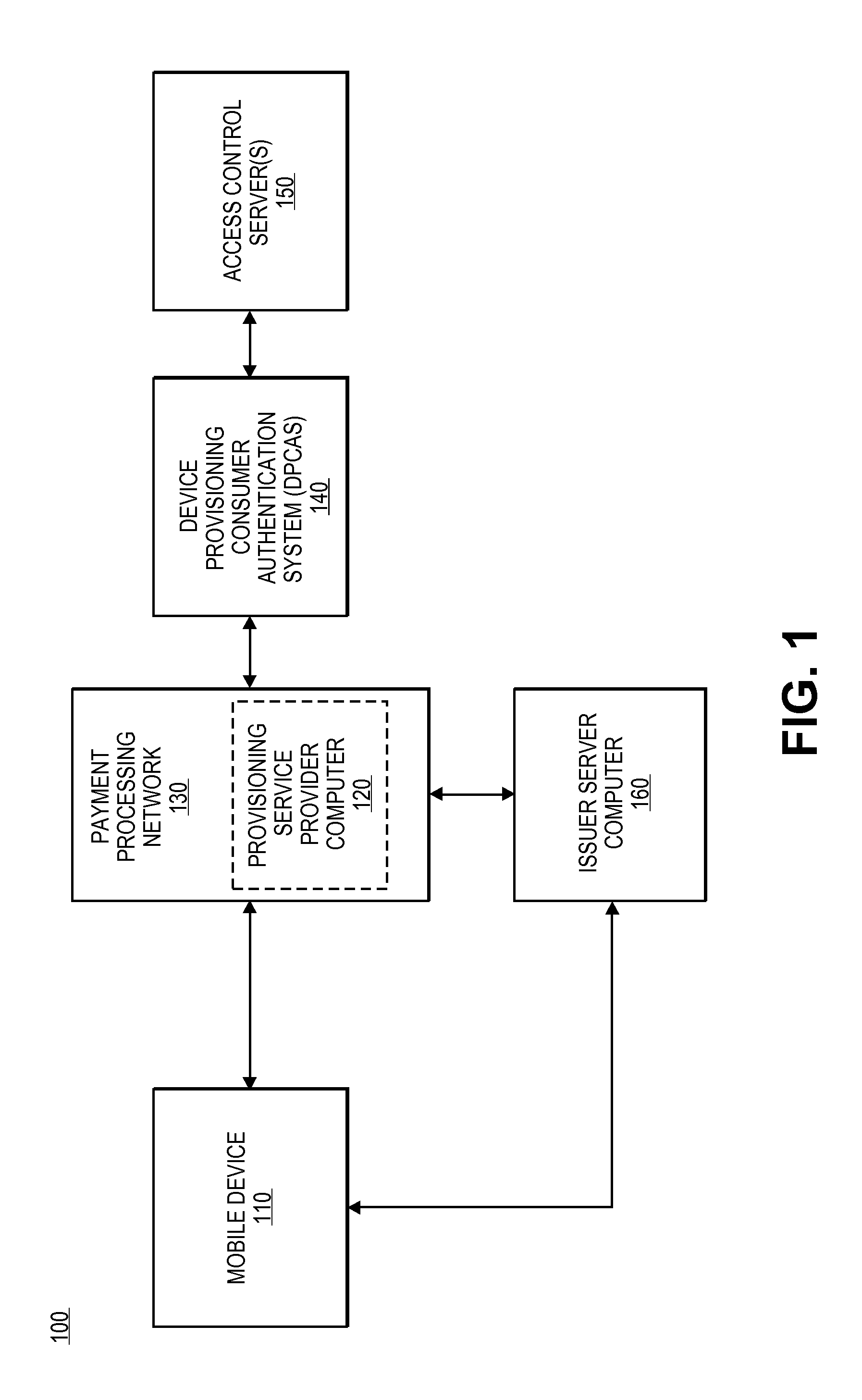

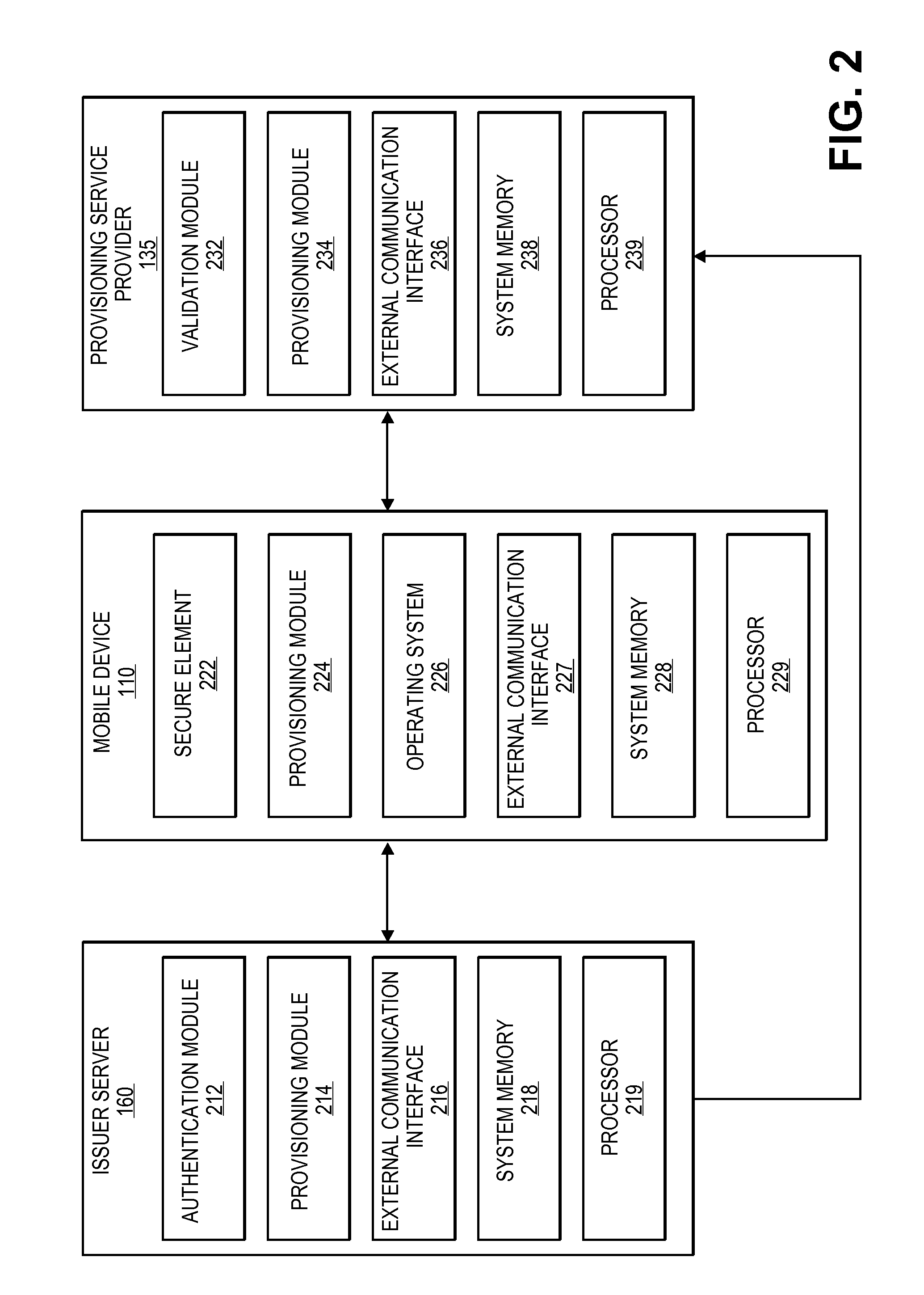

Automated Account Provisioning

Embodiments of the present invention are directed to systems, methods, and apparatus for allowing an issuer to initiate account provisioning on a mobile device without interacting with an accountholder. The issuer may initiate the process by sending a provisioning information request message to a mobile device with a secure element. The mobile device may recognize the provisioning request message and gather the requisite provisioning information without requiring user input. The provisioning information may include information associated with the secure element of the mobile device. The mobile device may then send a provisioning request message to a provisioning system. The provisioning request message may include the requisite provisioning information to allow the provisioning system to provision the financial account on the secure element of the mobile device.

Owner:VISA INT SERVICE ASSOC

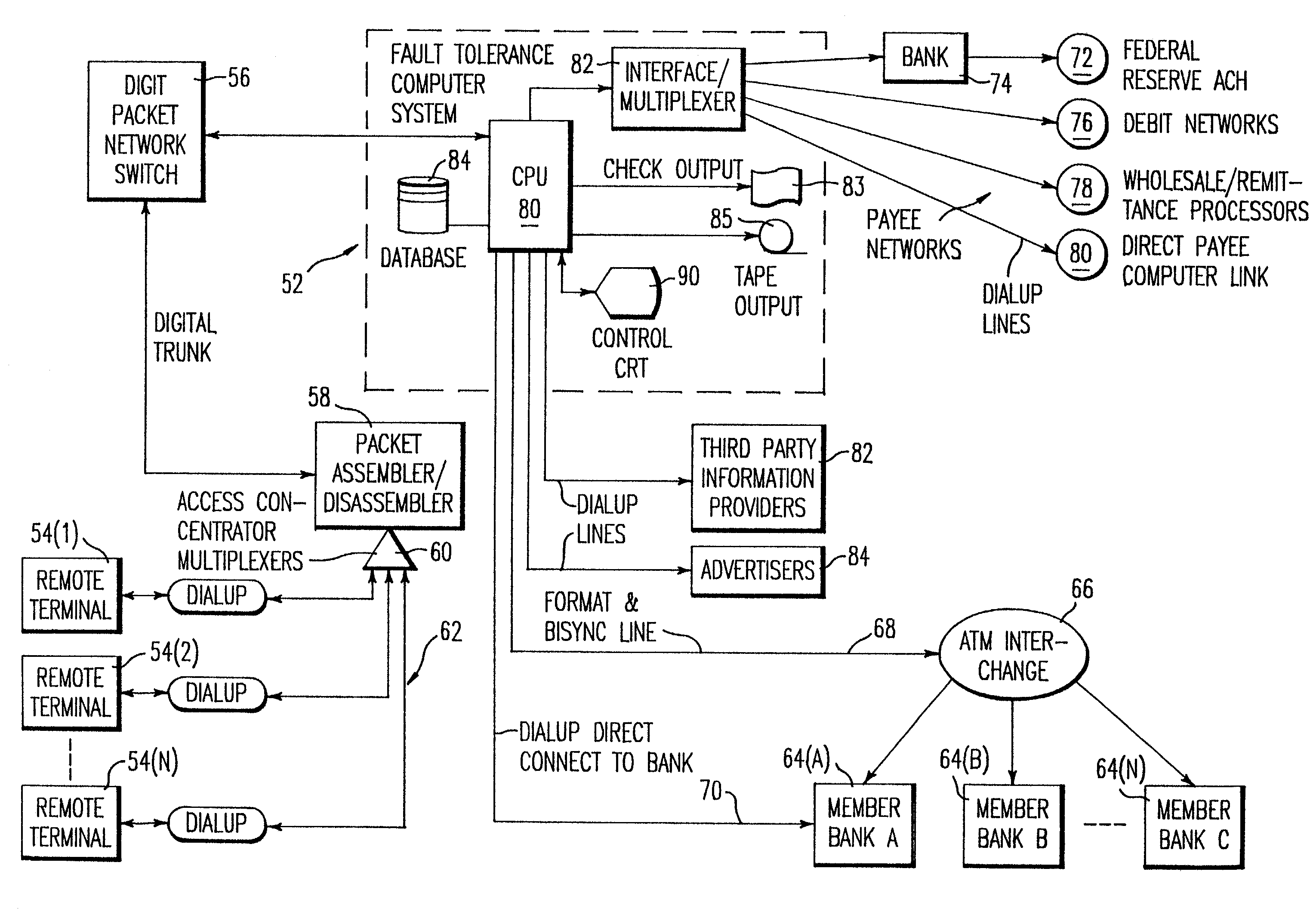

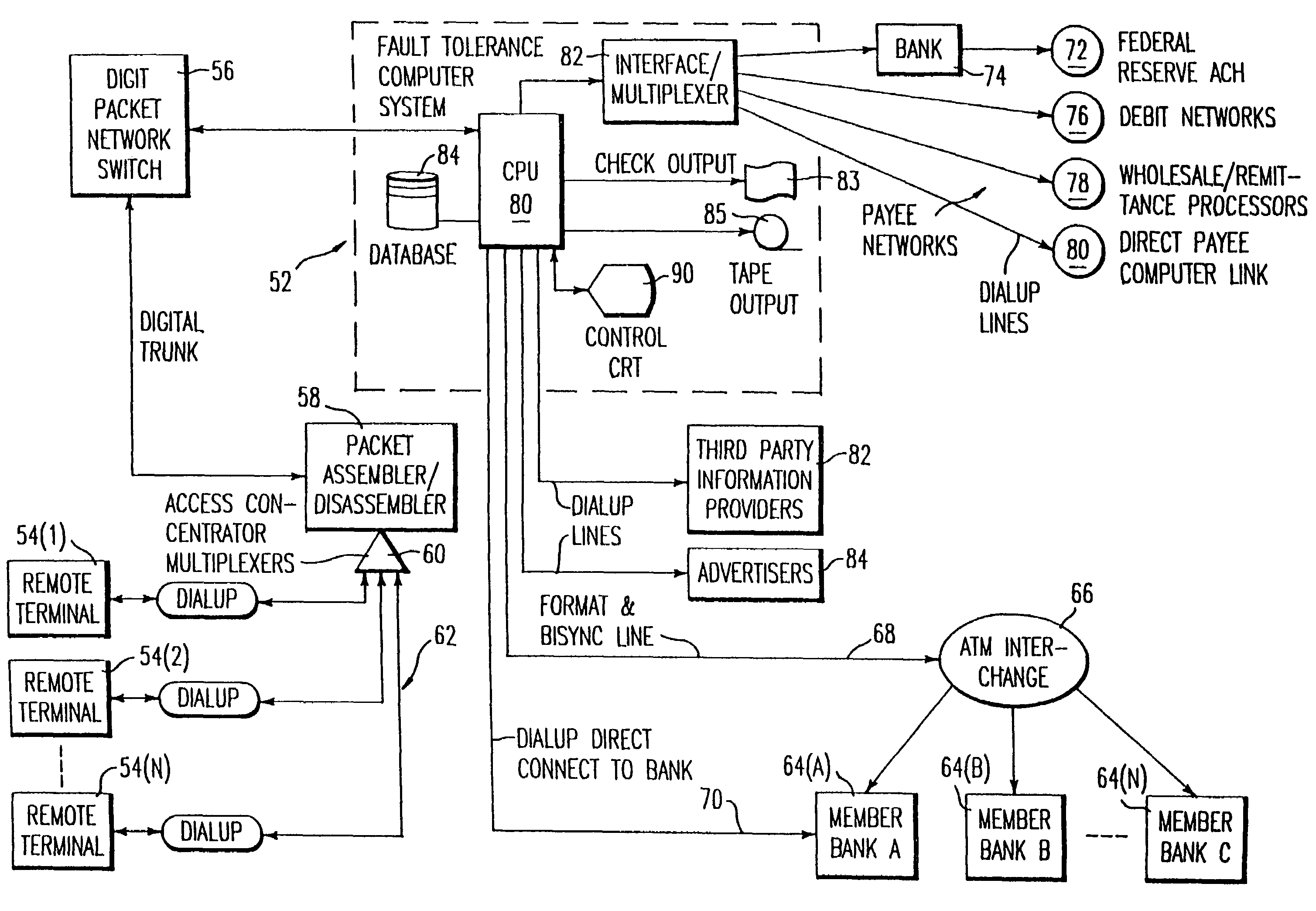

Method and system for remote delivery of retail banking services

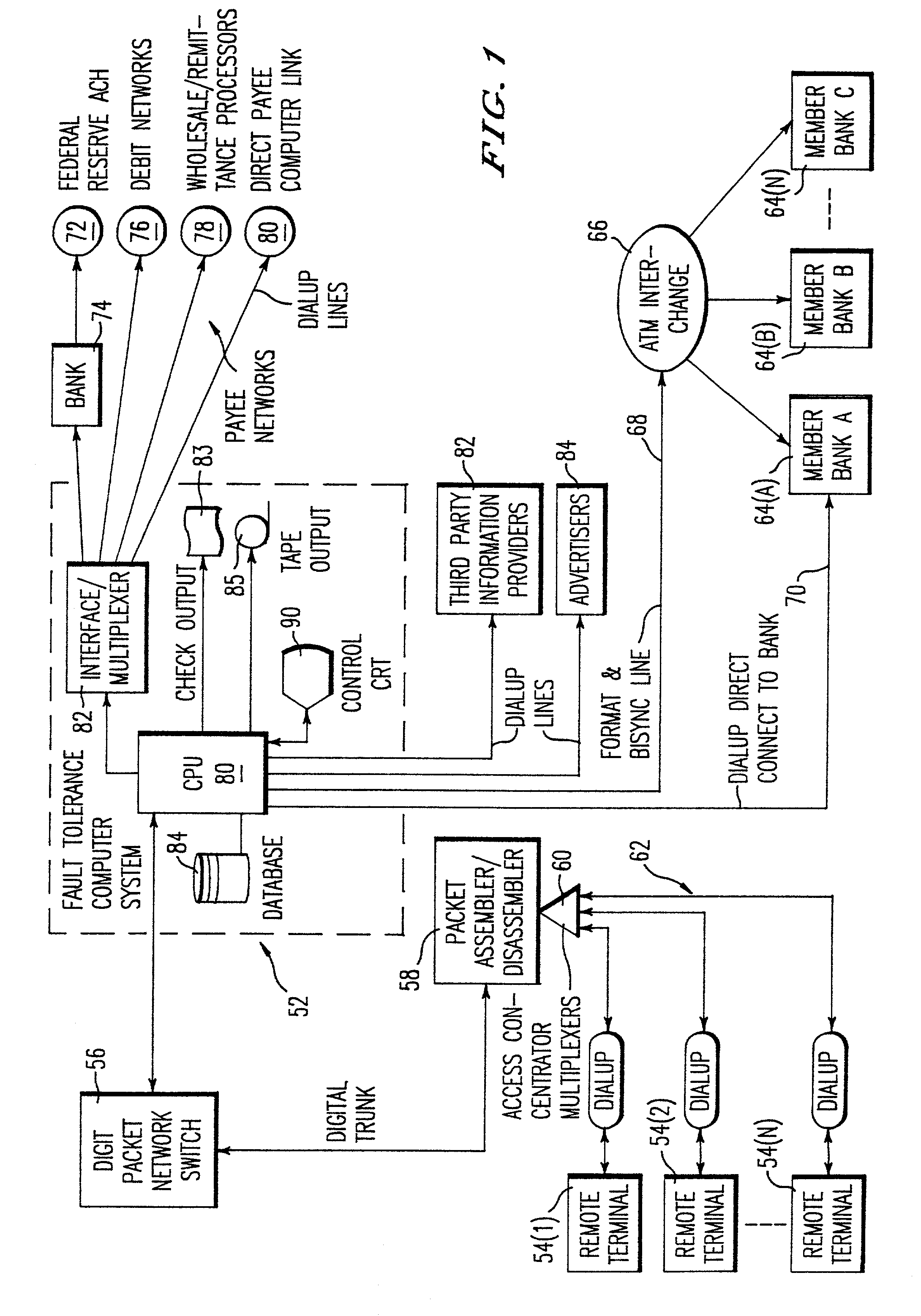

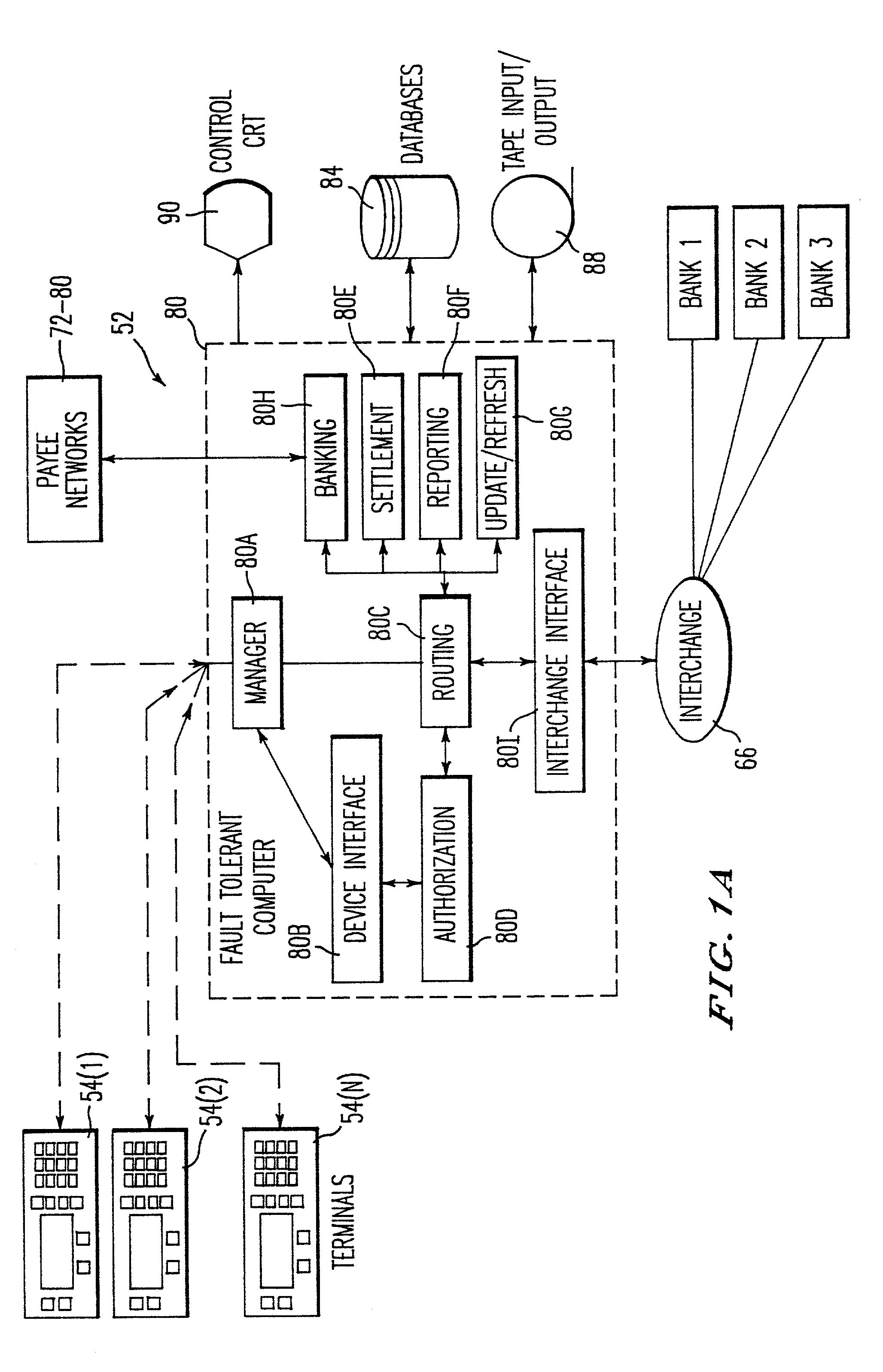

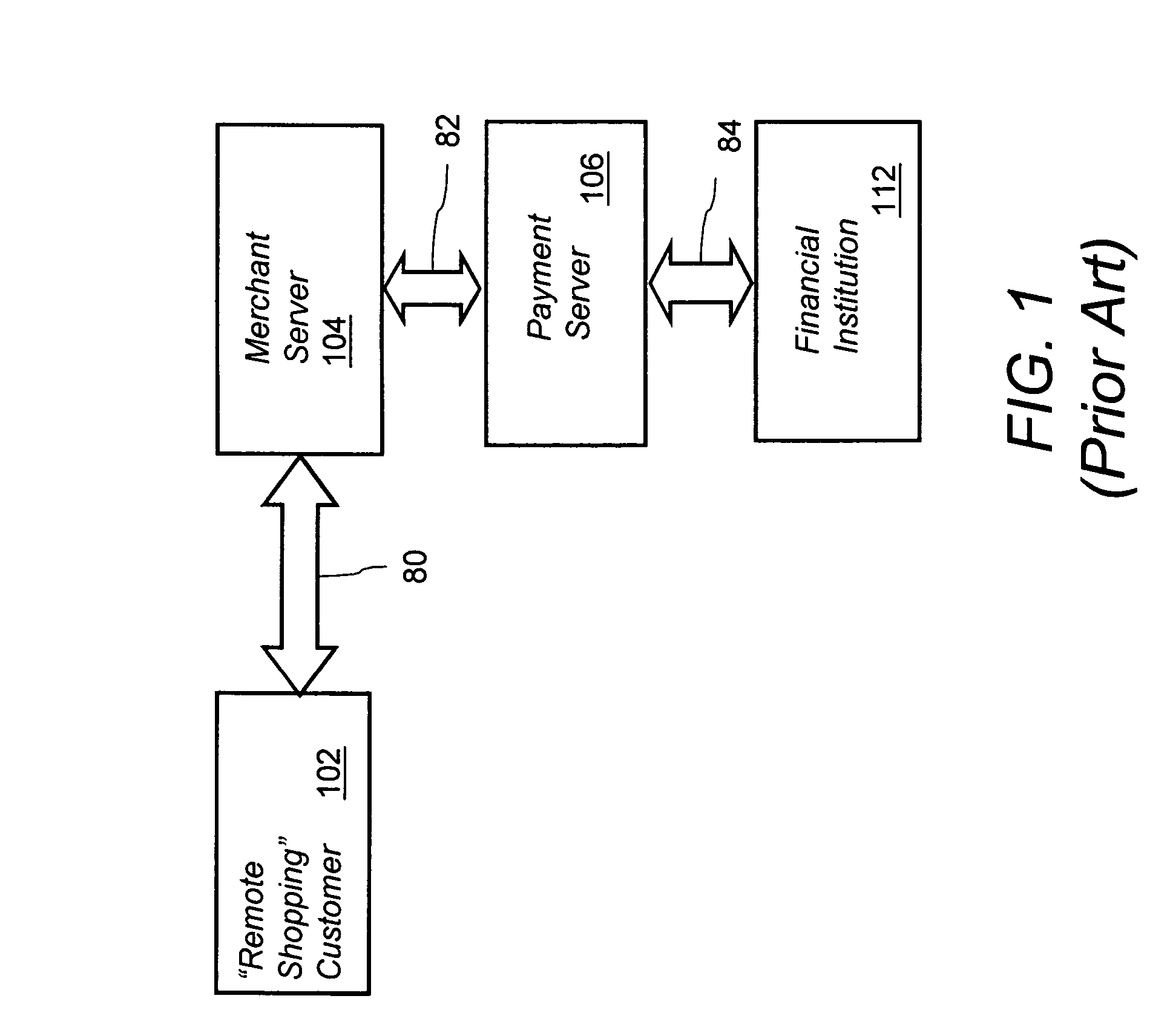

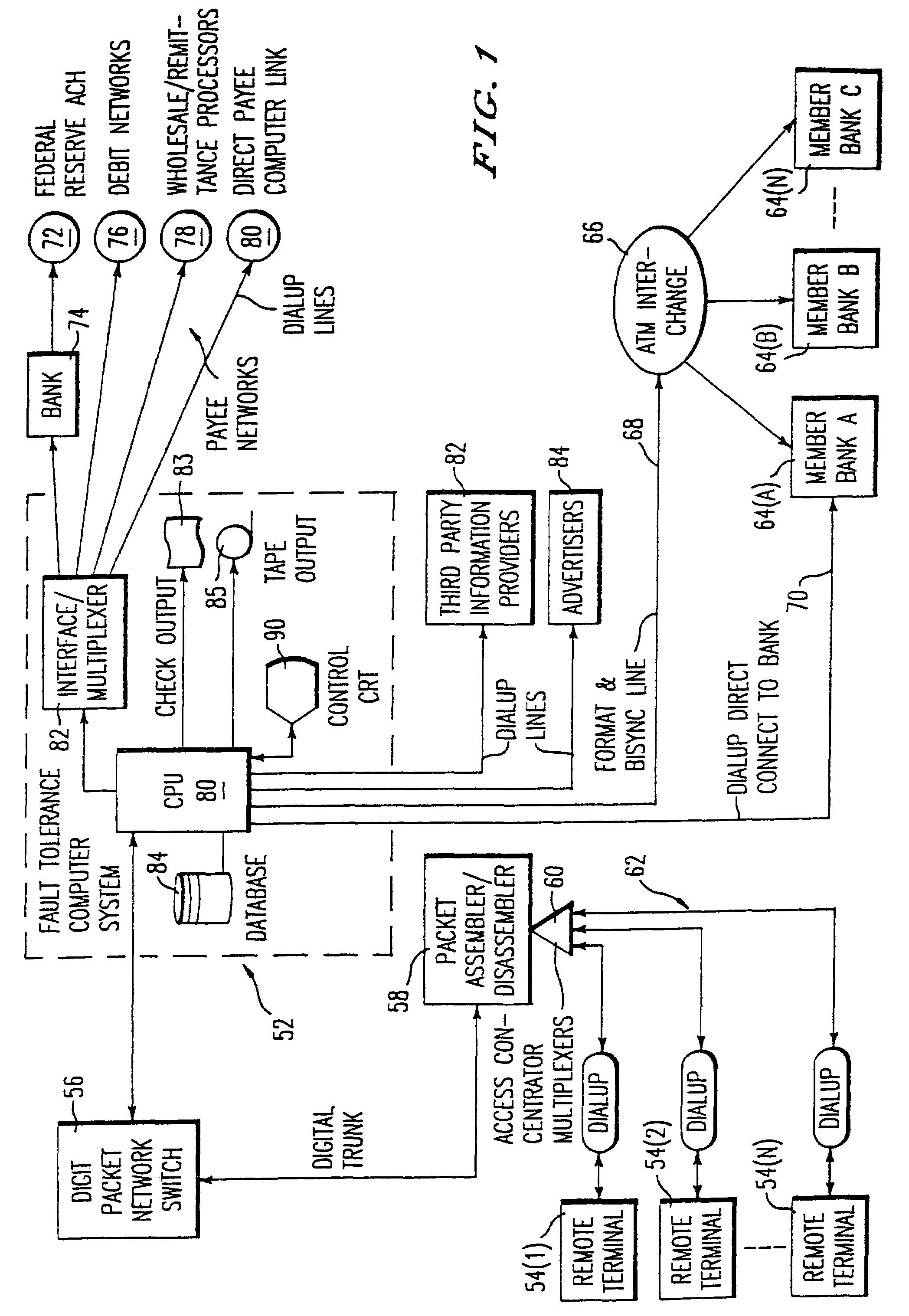

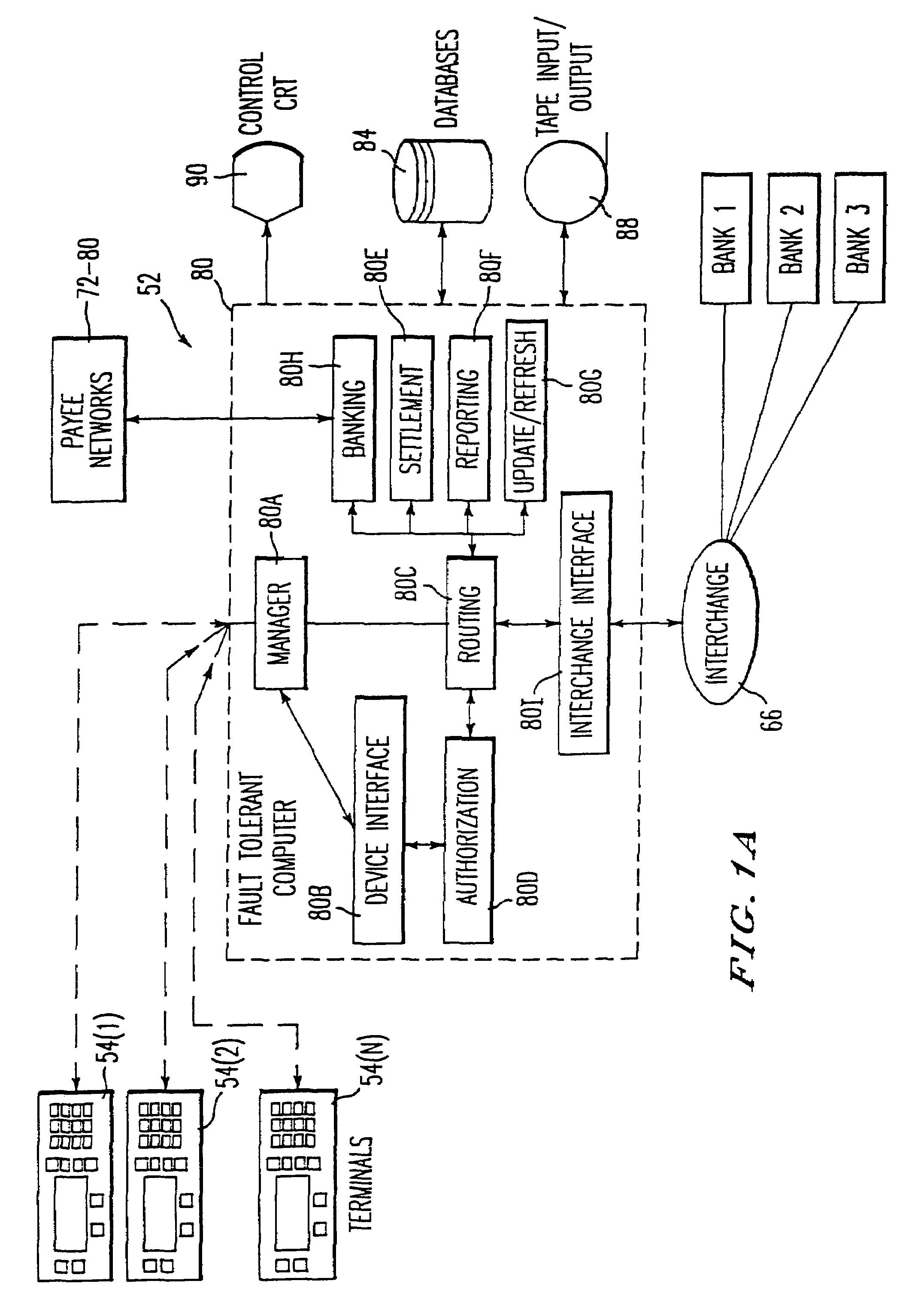

A practical system and method for the remote distribution of financial services (e.g., home banking and bill-paying) involves distributing portable terminals to a user base. The terminals include a multi-line display, keys “pointing to” lines on the display, and additional keys. Contact is established between the terminals and a central computer operated by a service provider, preferably over a dial-up telephone line and a packet data network. Information exchange between the central computer and the terminal solicits information from the terminal user related to requested financial services (e.g., for billpaying, the user provides payee selection and amount and his bank account PIN number). The central computer then transmits a message over a conventional ATM network debiting the user's bank account in real time, and may pay the specified payees the specified amount electronically or in other ways as appropriate. Payments and transfers may be scheduled in advance or on a periodic basis. Because the central computer interacts with the user's bank as a standard POS or ATM network node, no significant software changes are required at the banks' computers. The terminal interface is extremely user-friendly and incorporates some features of standard ATM user interfaces so as to reduce new user anxiety.

Owner:OFFICIAL PAYMENTS

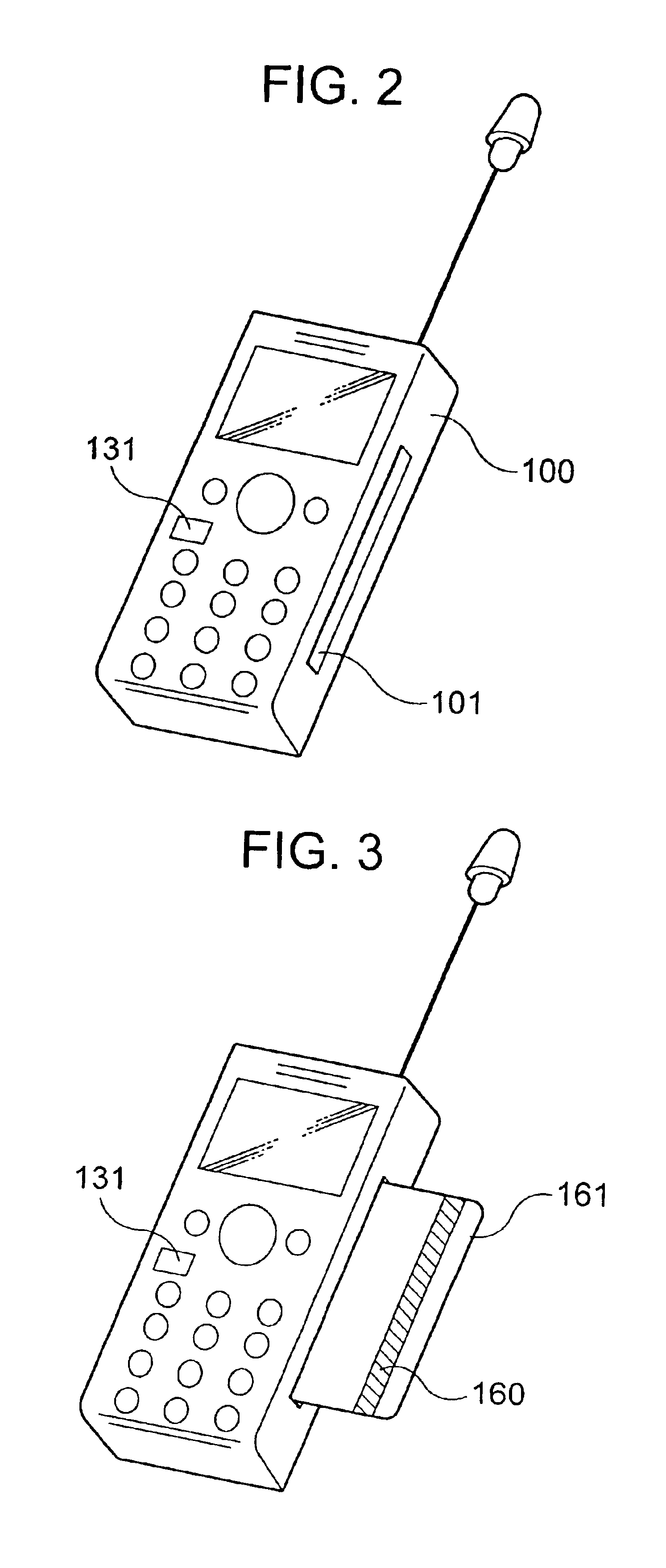

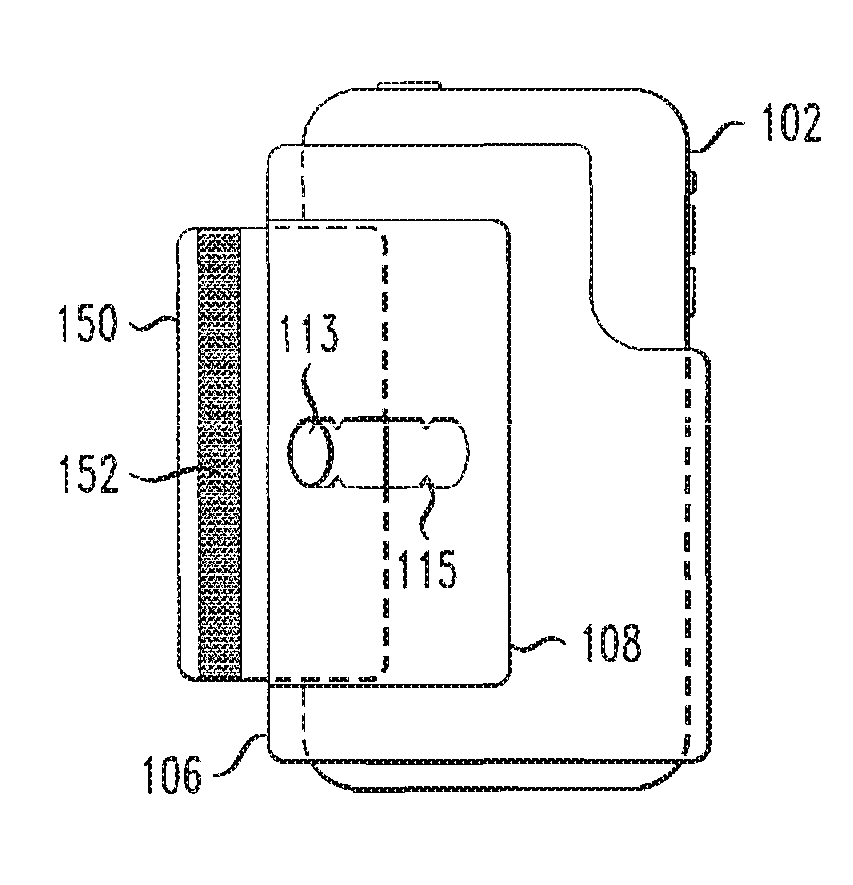

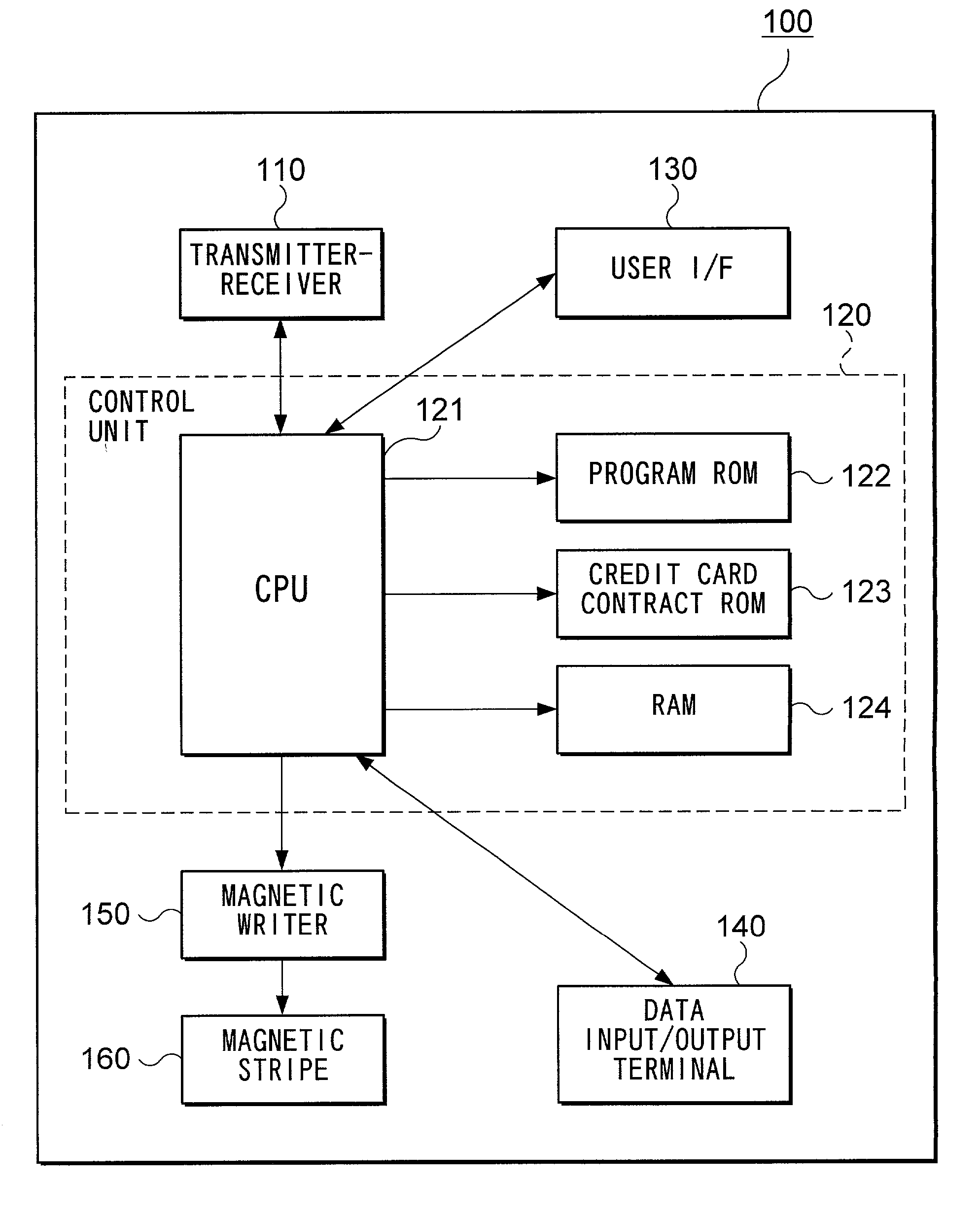

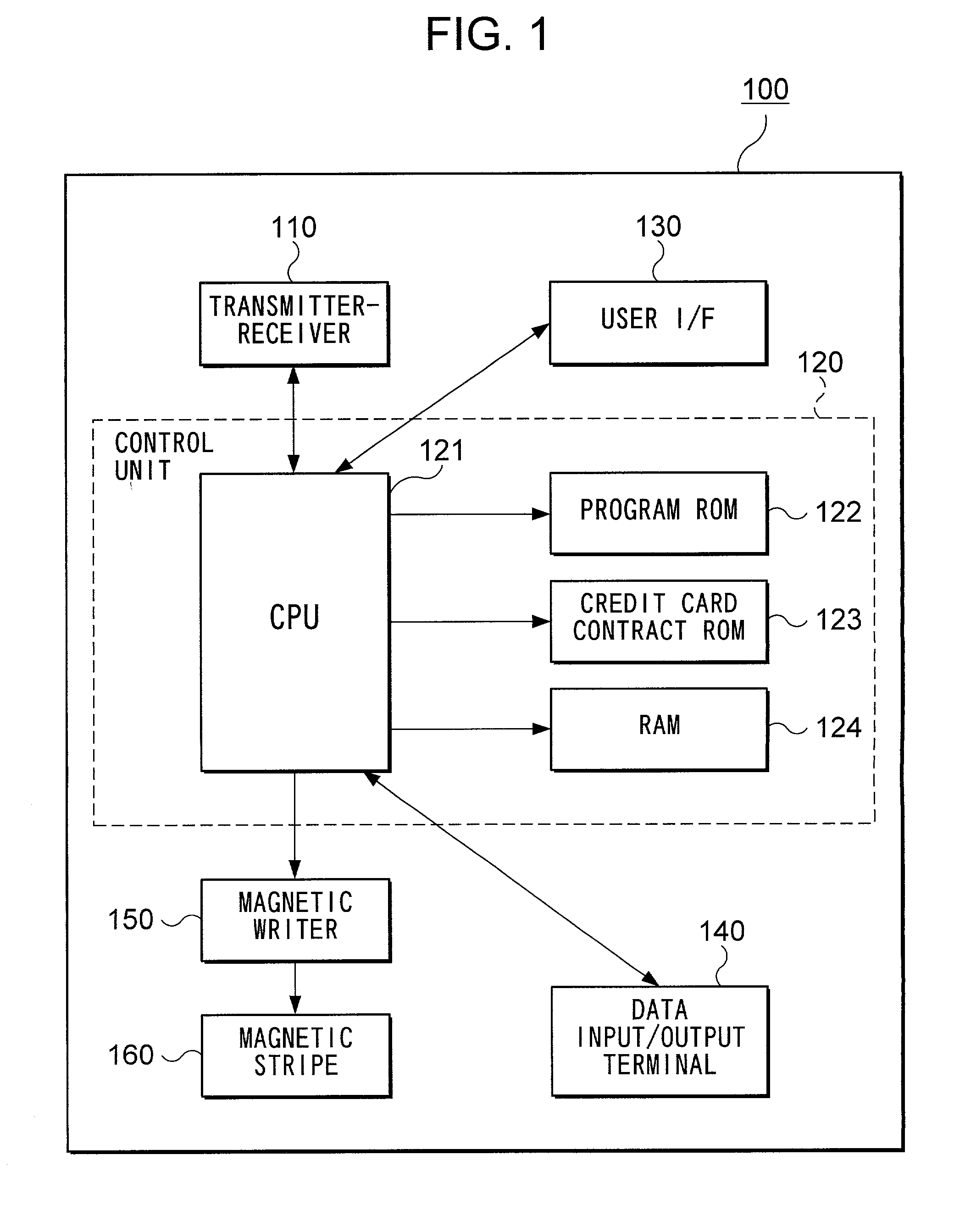

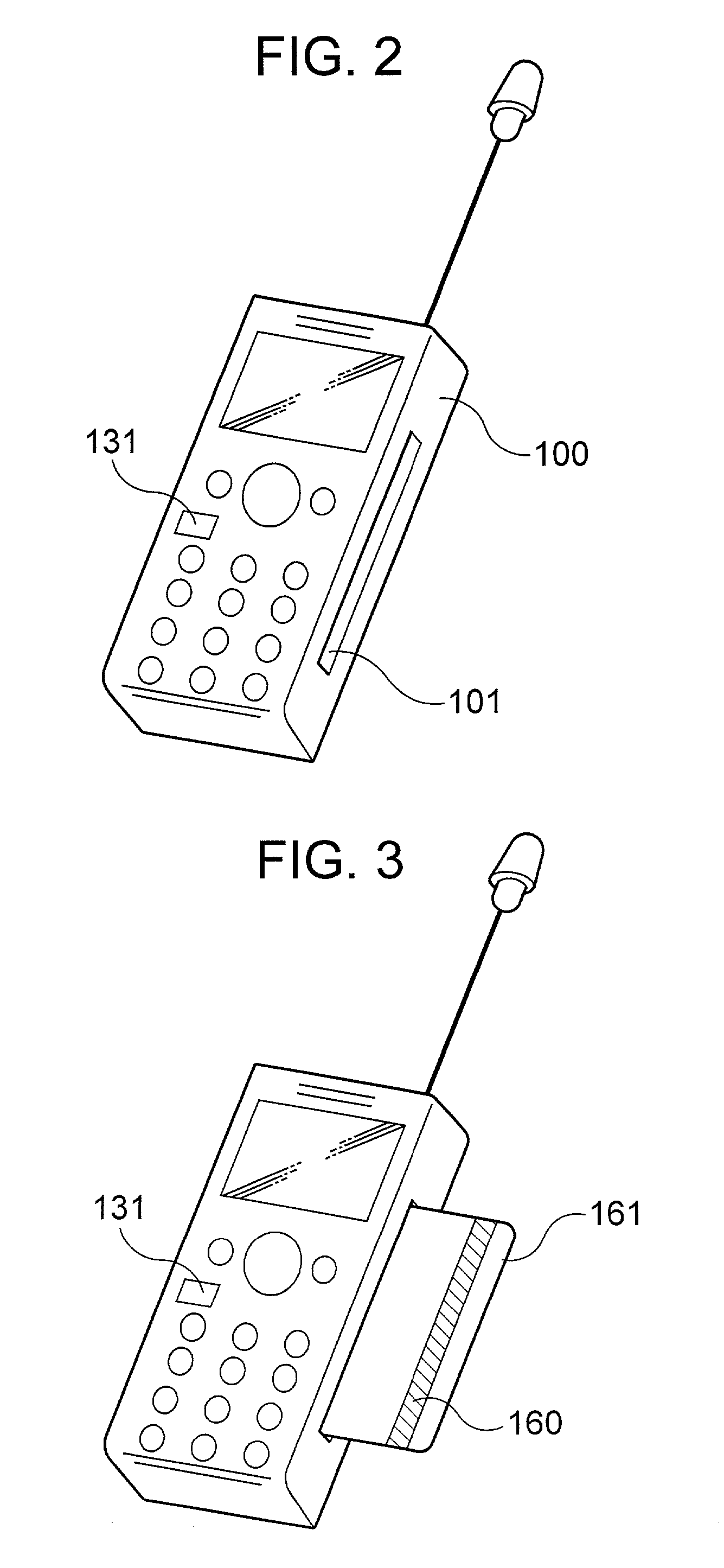

Mobile communication terminal and card information reading device

InactiveUS6910624B1Credit registering devices actuationDevices with card reading facilityCredit cardComputer terminal

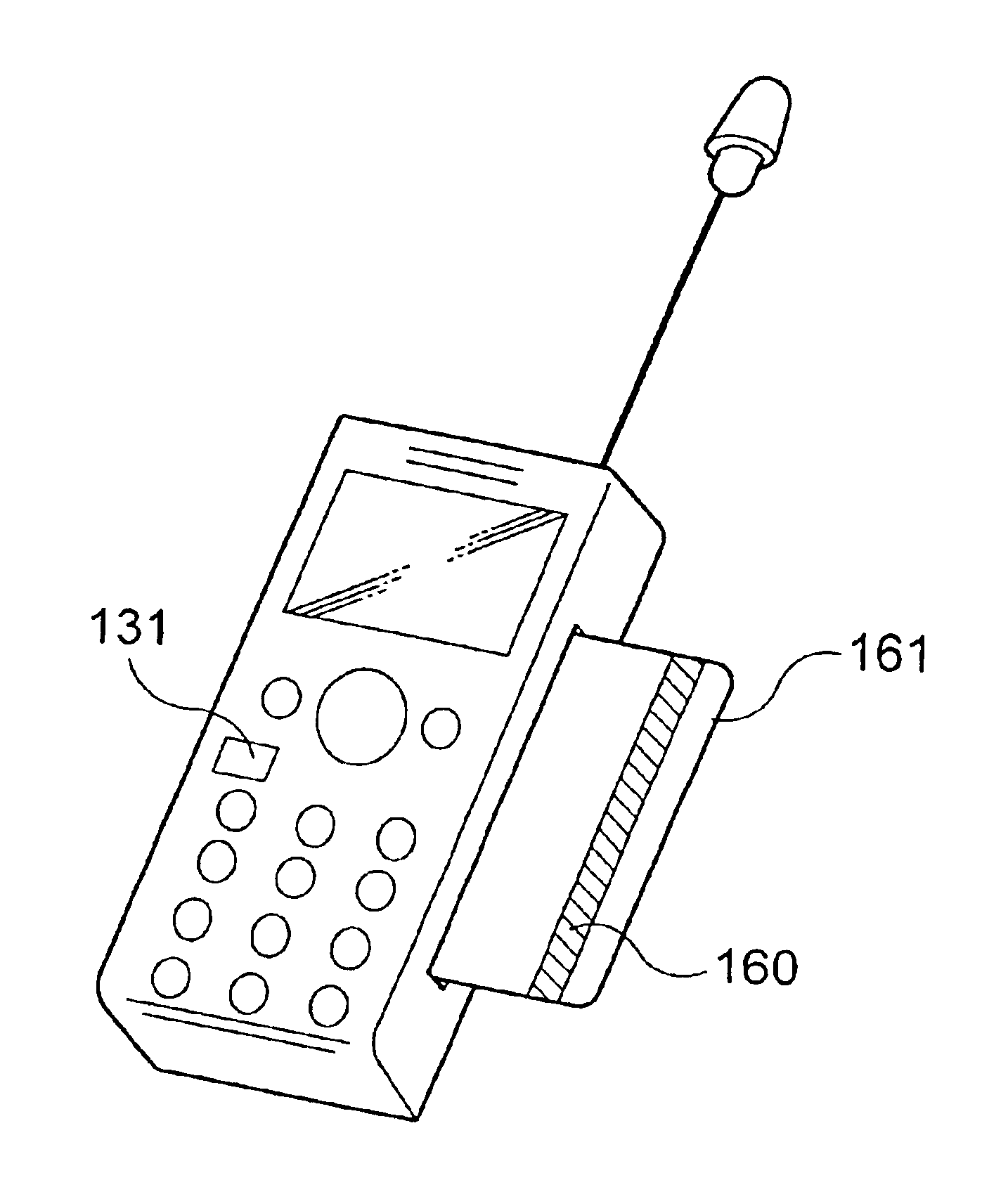

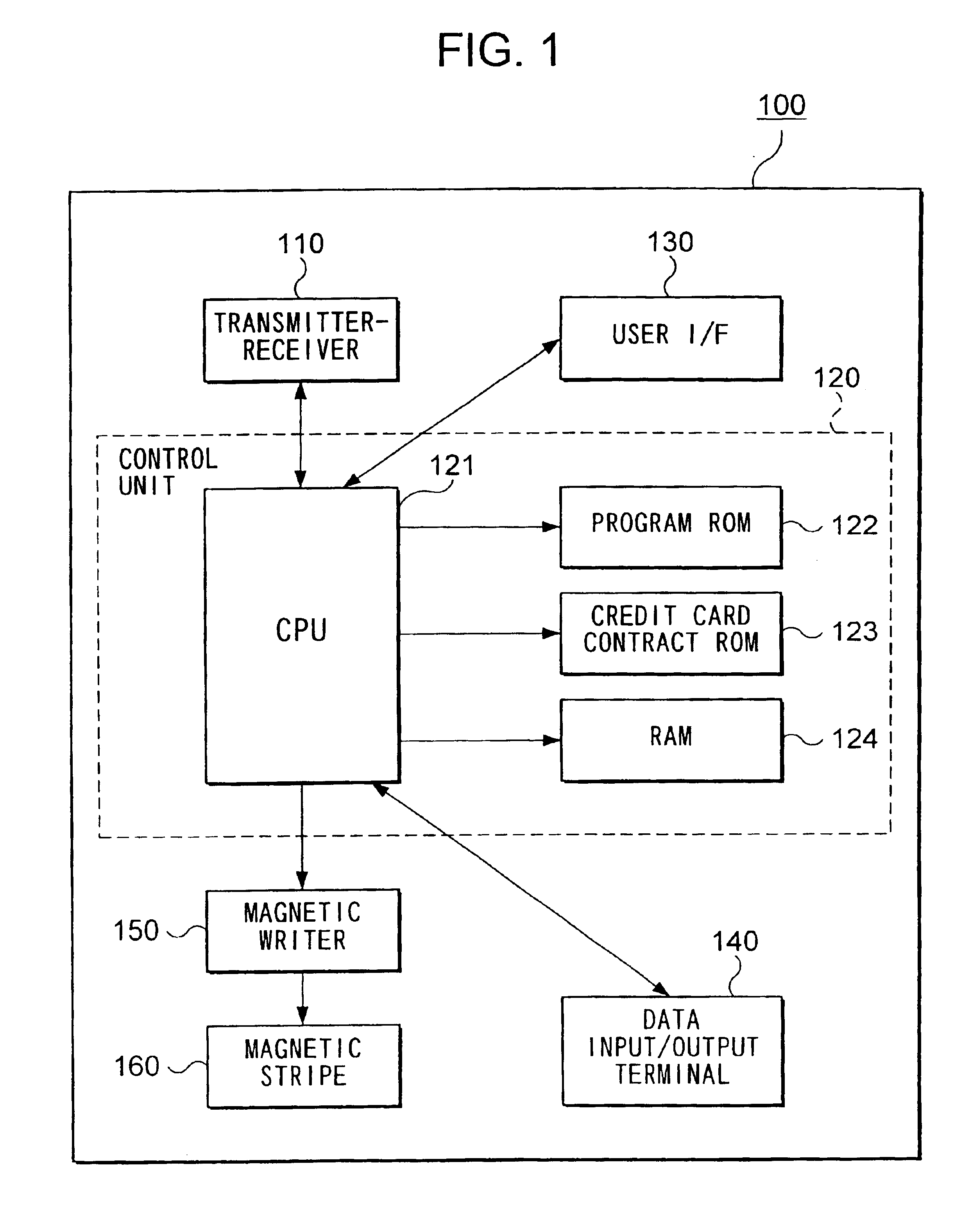

A mobile communication terminal (the mobile station 100), served in a mobile communication network for performing wireless communications, comprises a transmitter-receiver 110, a controller 120, a user interface 130, a data input / output terminal 140, a magnetic writer 150, and a magnetic stripe 160. Control programs stored in a program ROM 122 include a program for controlling the magnetic writer such as writes or deletes various information into / from the magnetic stripe 160. In a credit card ROM 123 are stored information on the attributes of a credit card contract concluded in advance between a user and a credit card company. The magnetic writer 150 writes credit card contract information provided from the controller 120 to the magnetic stripe 160 or deletes the credit card contract information from the magnetic stripe 160.

Owner:GOOGLE LLC

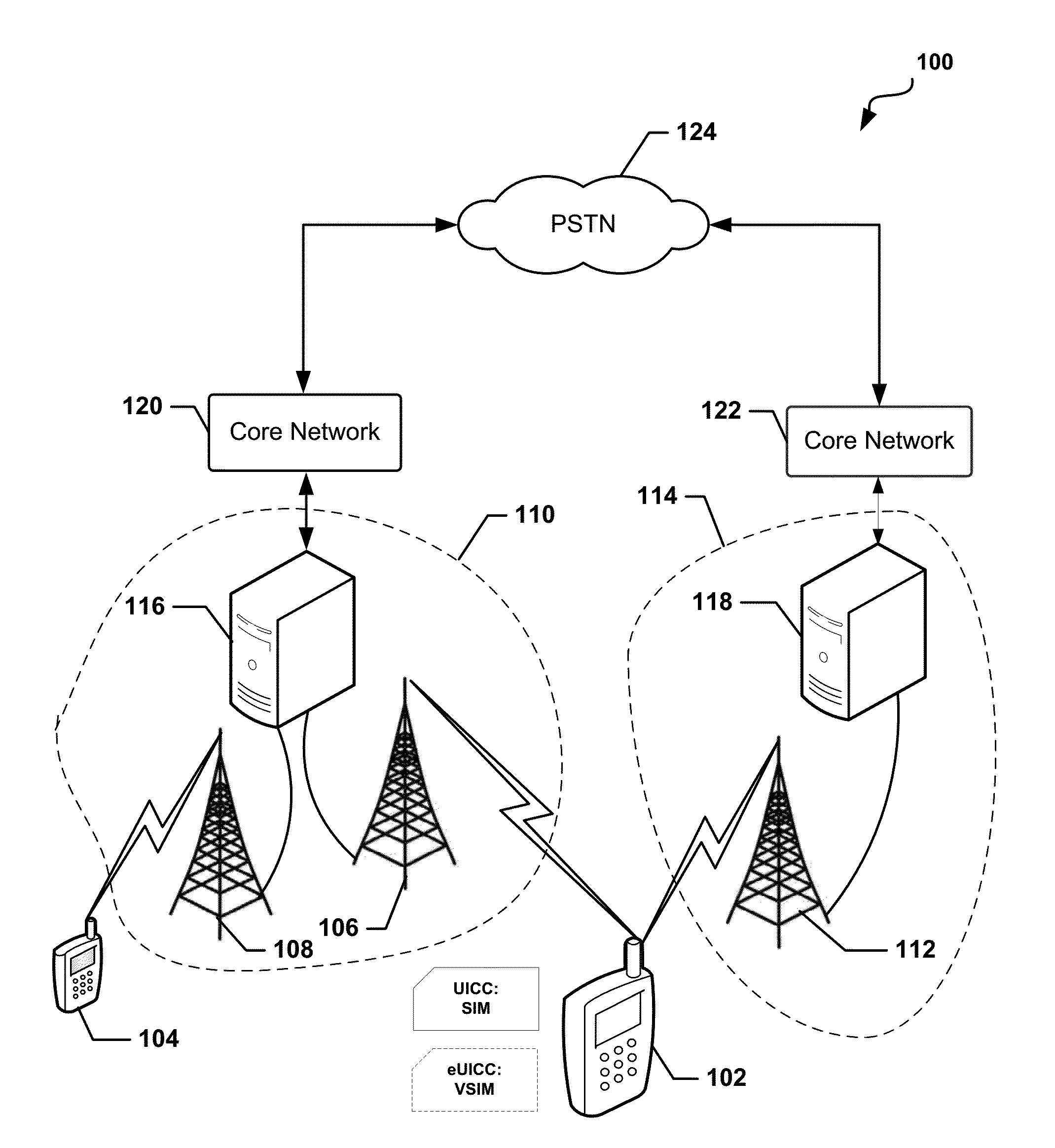

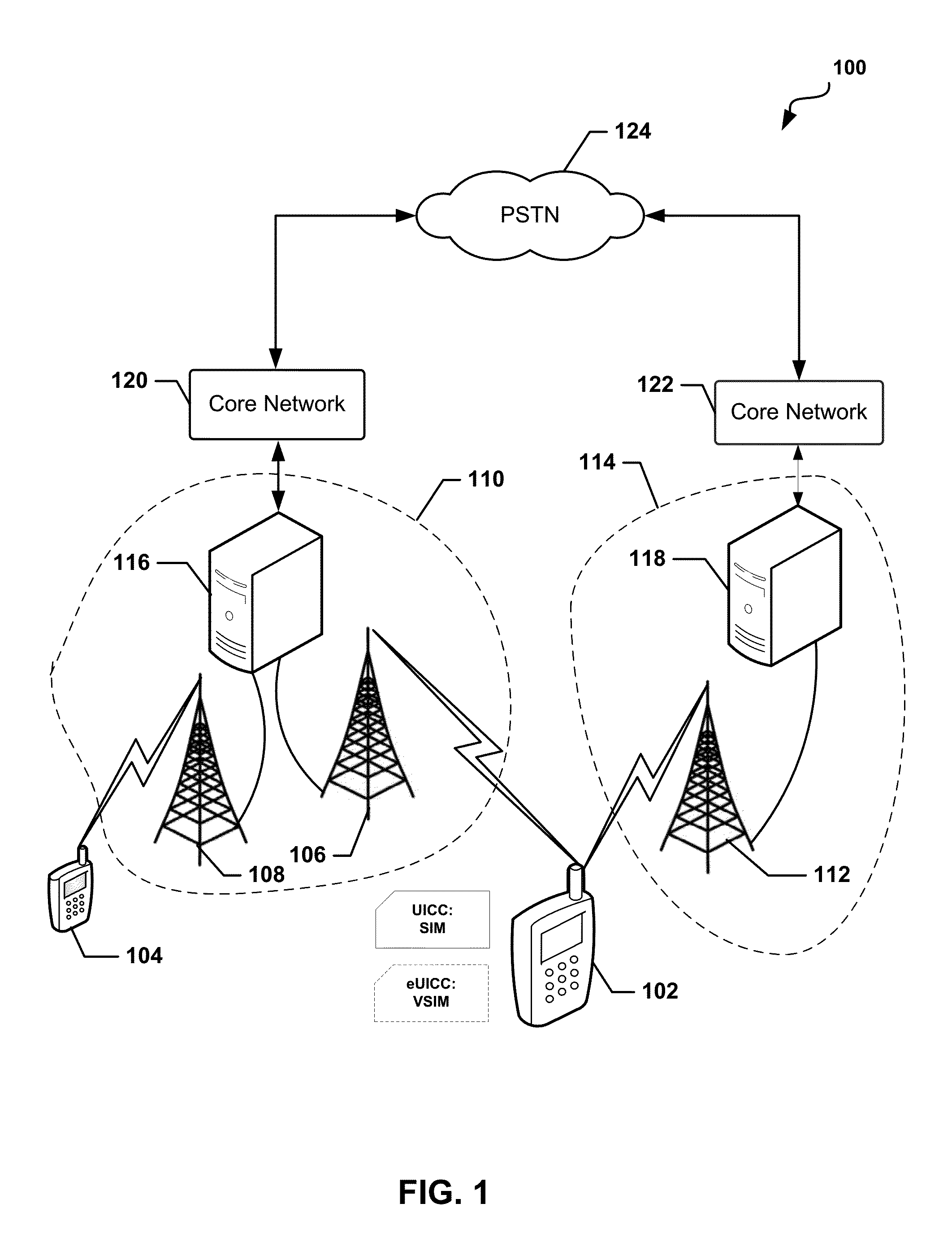

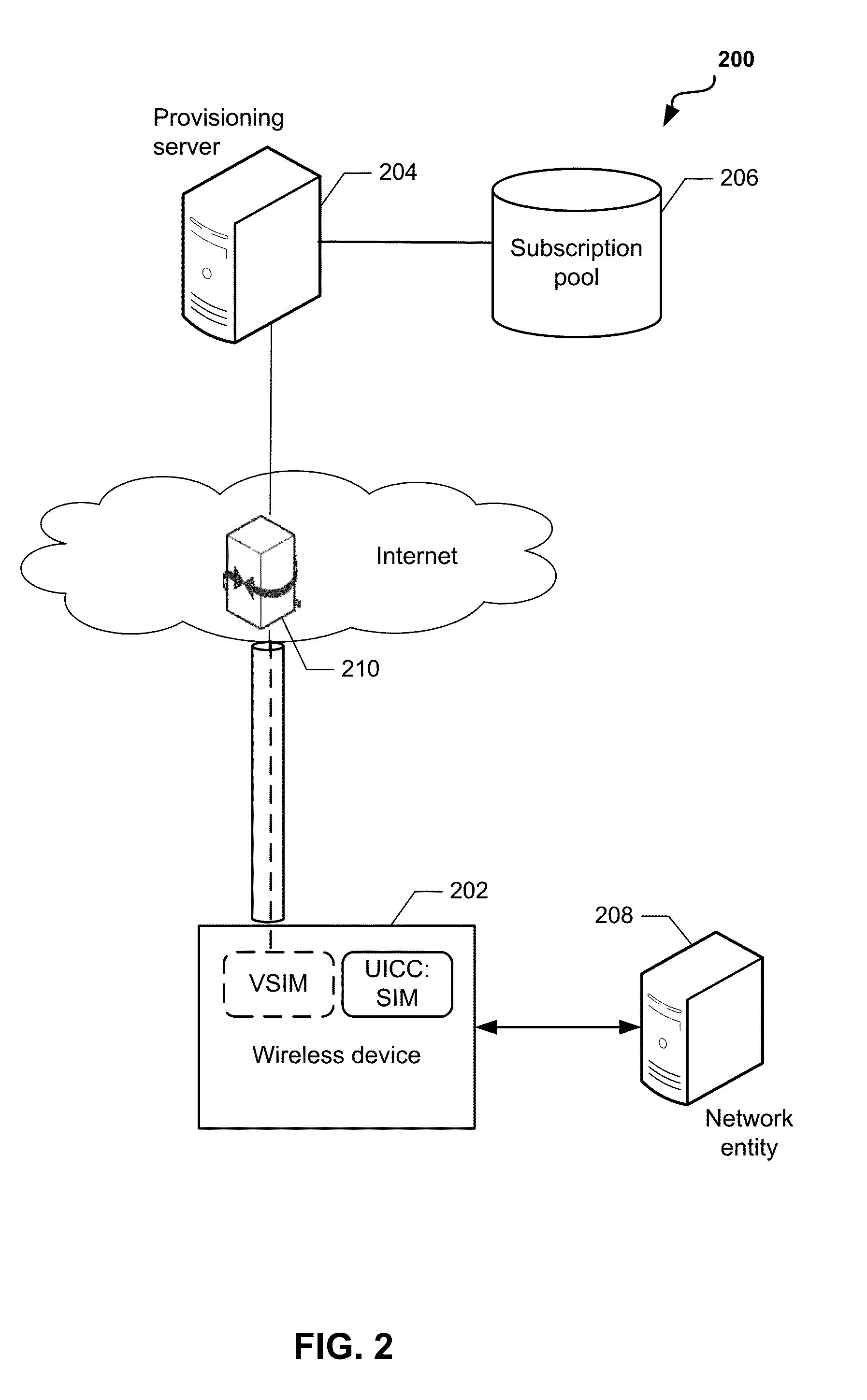

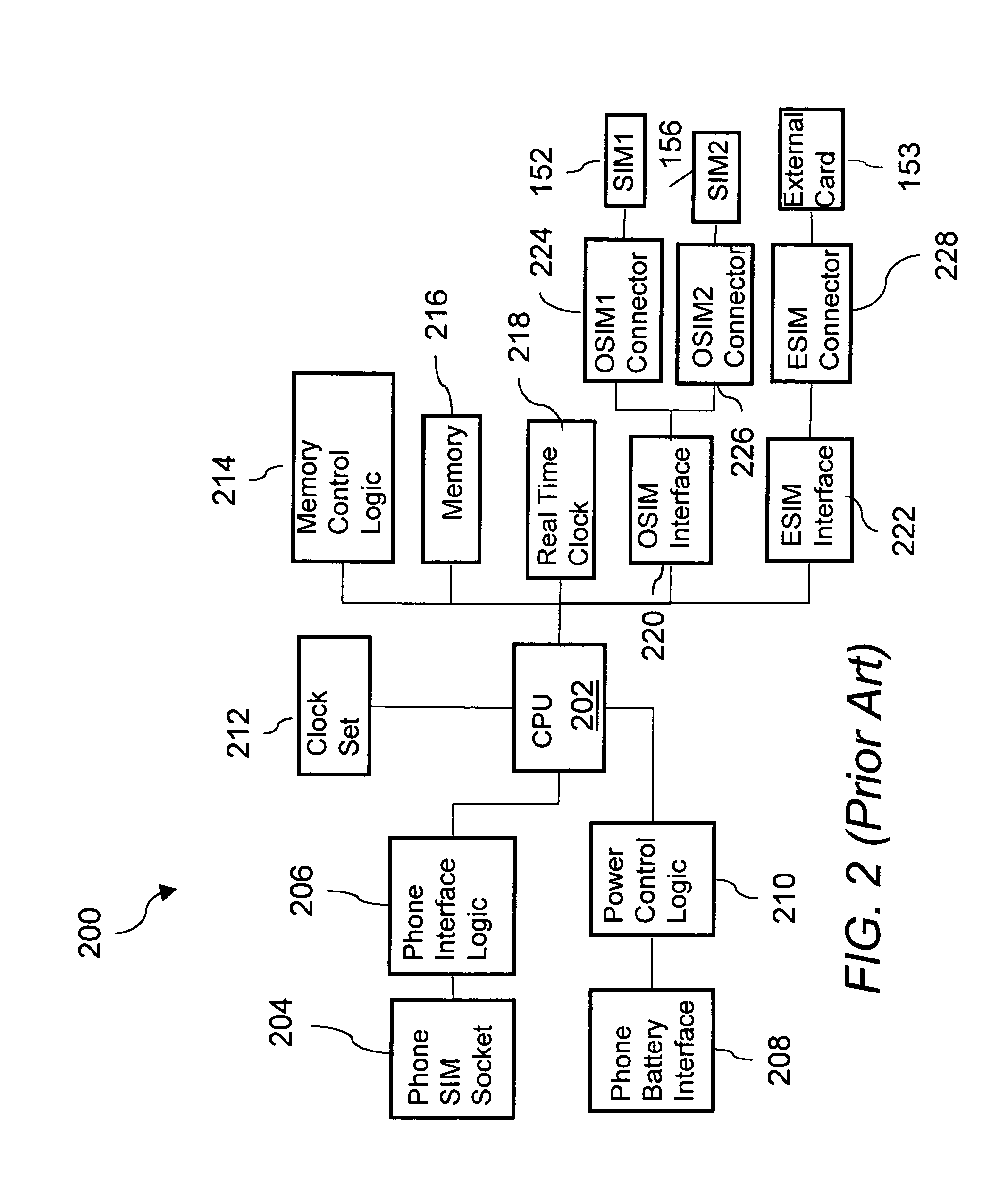

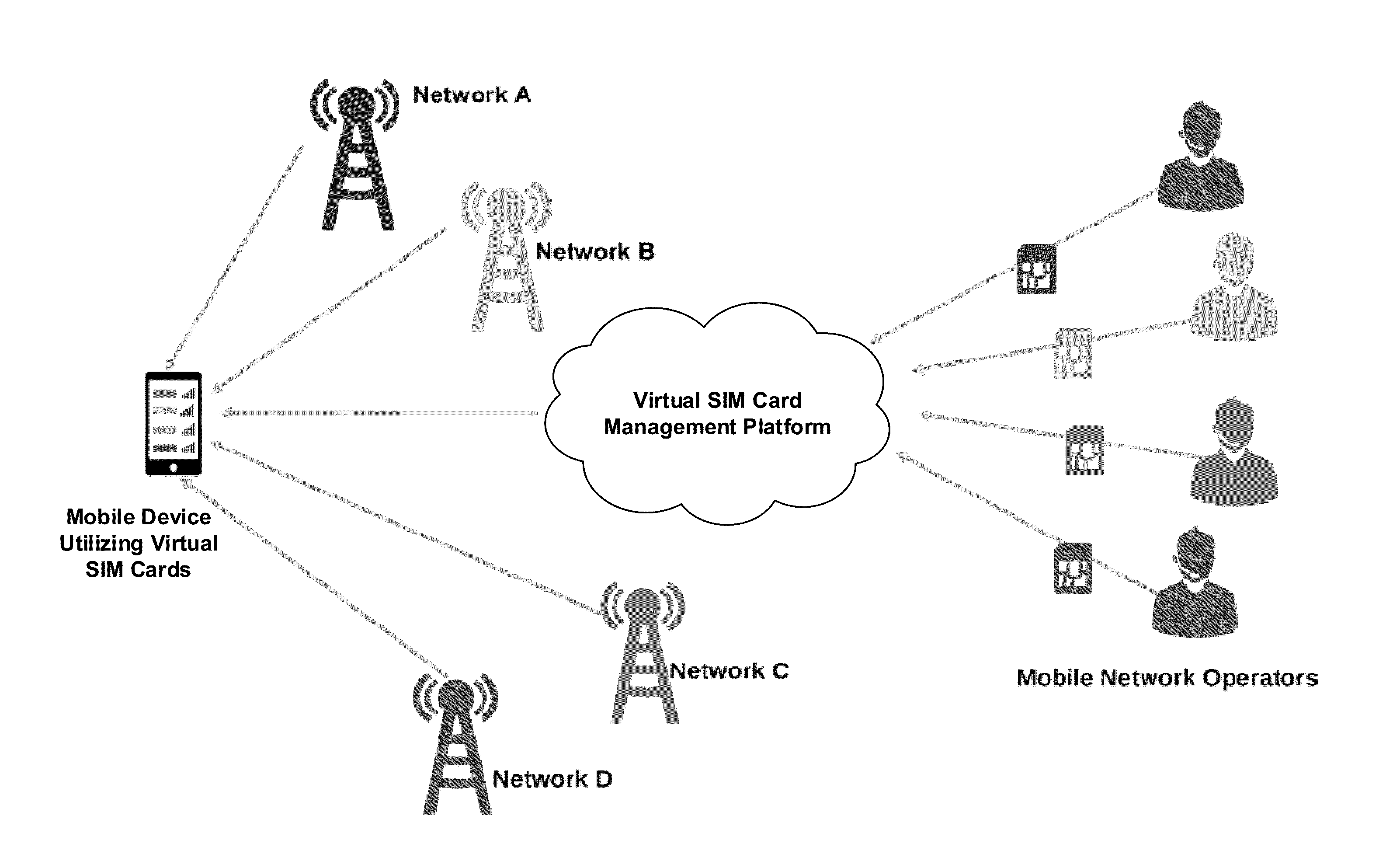

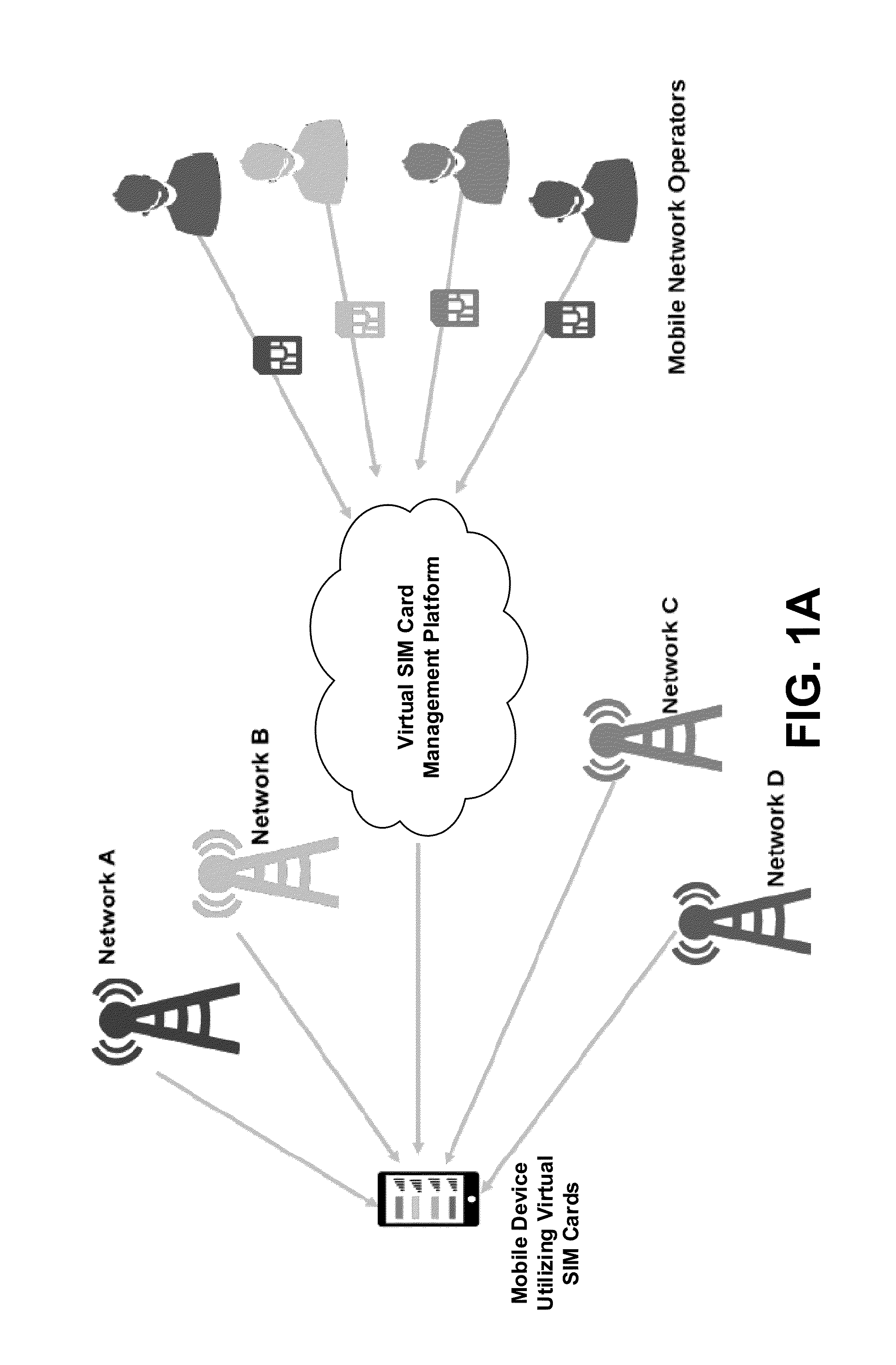

System and Methods for Dynamic SIM Provisioning on a Dual-SIM Wireless Communication Device

ActiveUS20150304506A1Accounting/billing servicesSecurity arrangementComputer hardwareCredential management

Methods and devices for dynamic VSIM provisioning on a multi-SIM wireless device having a first SIM as a Universal Integrated Circuit Card (UICC) and a virtual SIM (VSIM). A provisioning server may receive updated information from the wireless device, and based at least partially on the received information, determine whether the SIM profile on the VSIM of the wireless device should be changed. To change the SIM profile, the provisioning server may determine whether remote credential management procedures are enabled. If so, the provisioning server may select a new SIM profile from a plurality of SIM profiles, and provision the new SIM profile in the VSIM using remote credential management procedures. If remote credential management procedures are unavailable, the provisioning server may select a remote SIM from a plurality of remote SIMs associated with the provisioning server, and run the remote SIM to execute authentication processes for the wireless device.

Owner:QUALCOMM INC

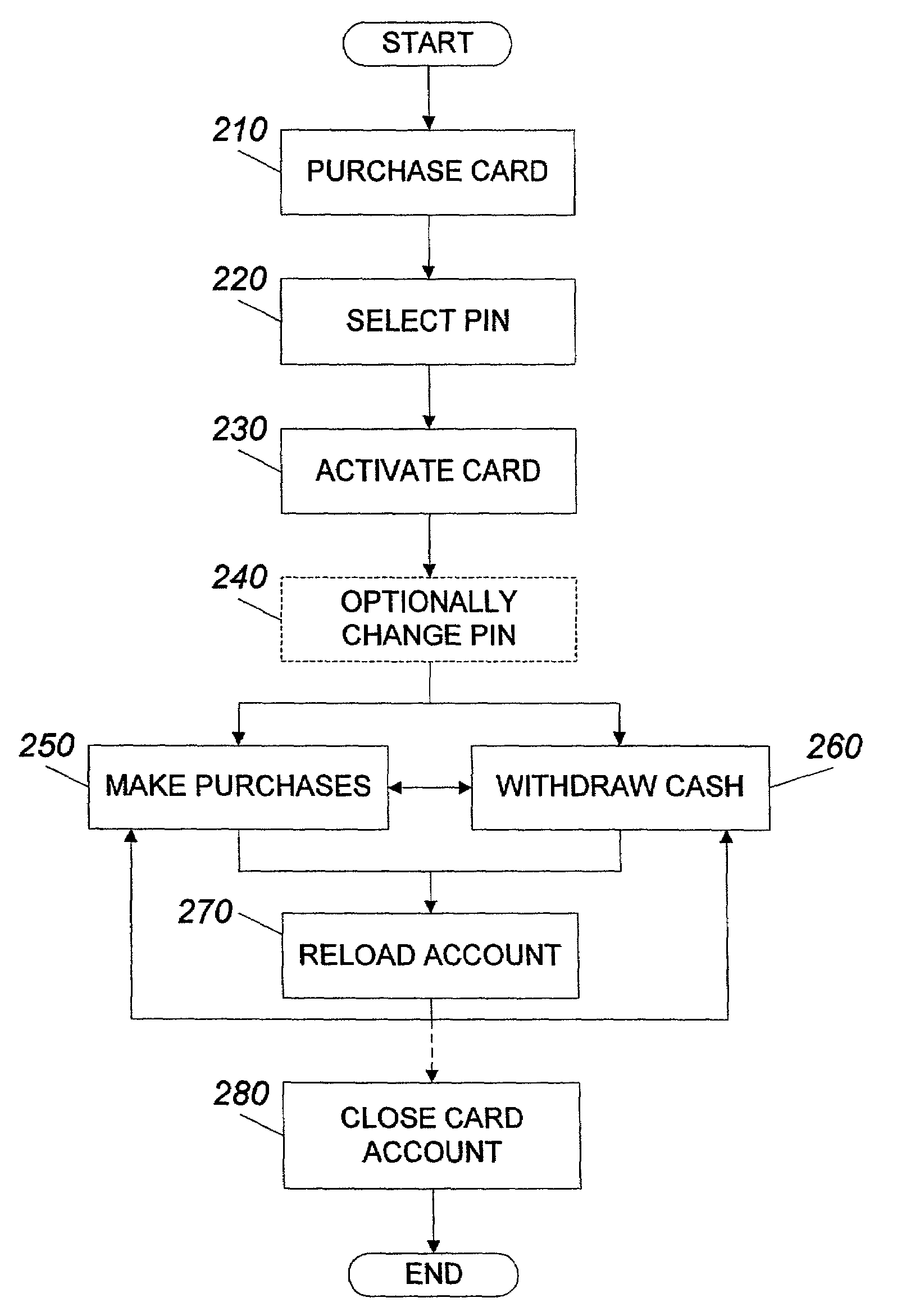

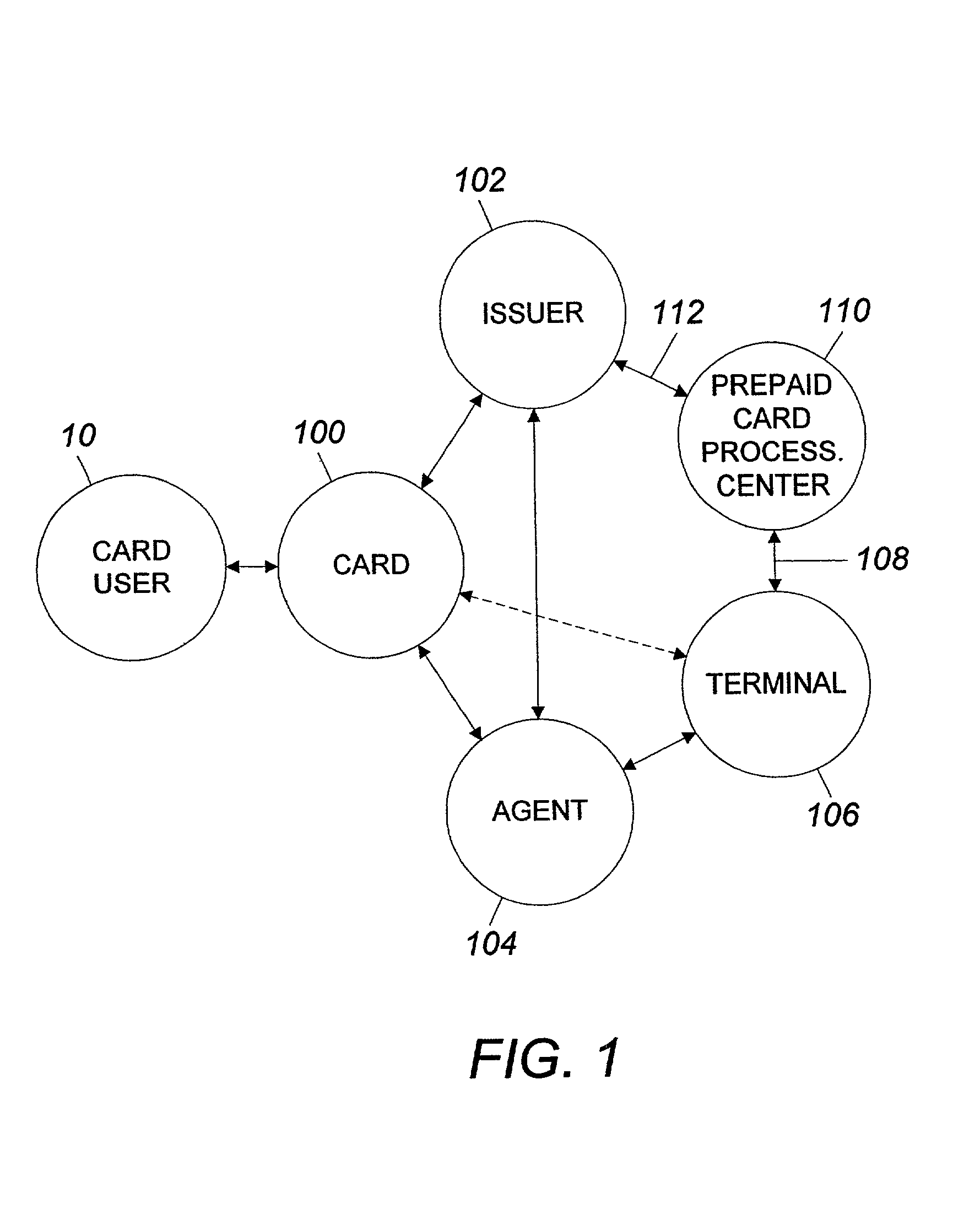

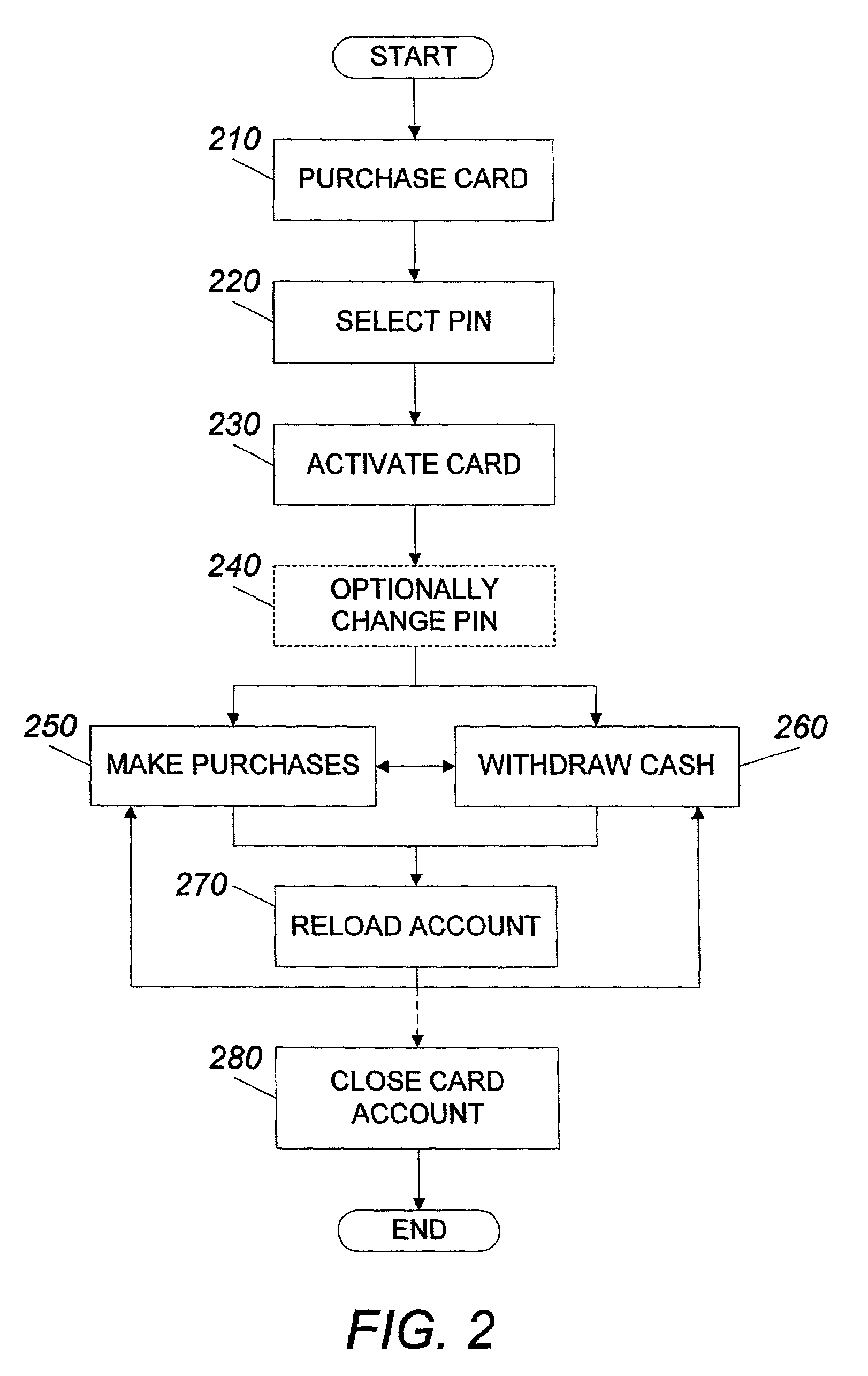

System and method for using a prepaid card

InactiveUS6999569B2Increase valueMeet the need for flexibilityCredit registering devices actuationBilling/invoicingFinancial transactionOperating system

A system and method for transferring money by use of a prepaid card account is disclosed wherein two cards are issued to the user accountholder, one of which is provided to another user, and either user may add value to the prepaid account so that the other user may use the card and that value in a financial transaction.

Owner:THOMSON LICENSING SA

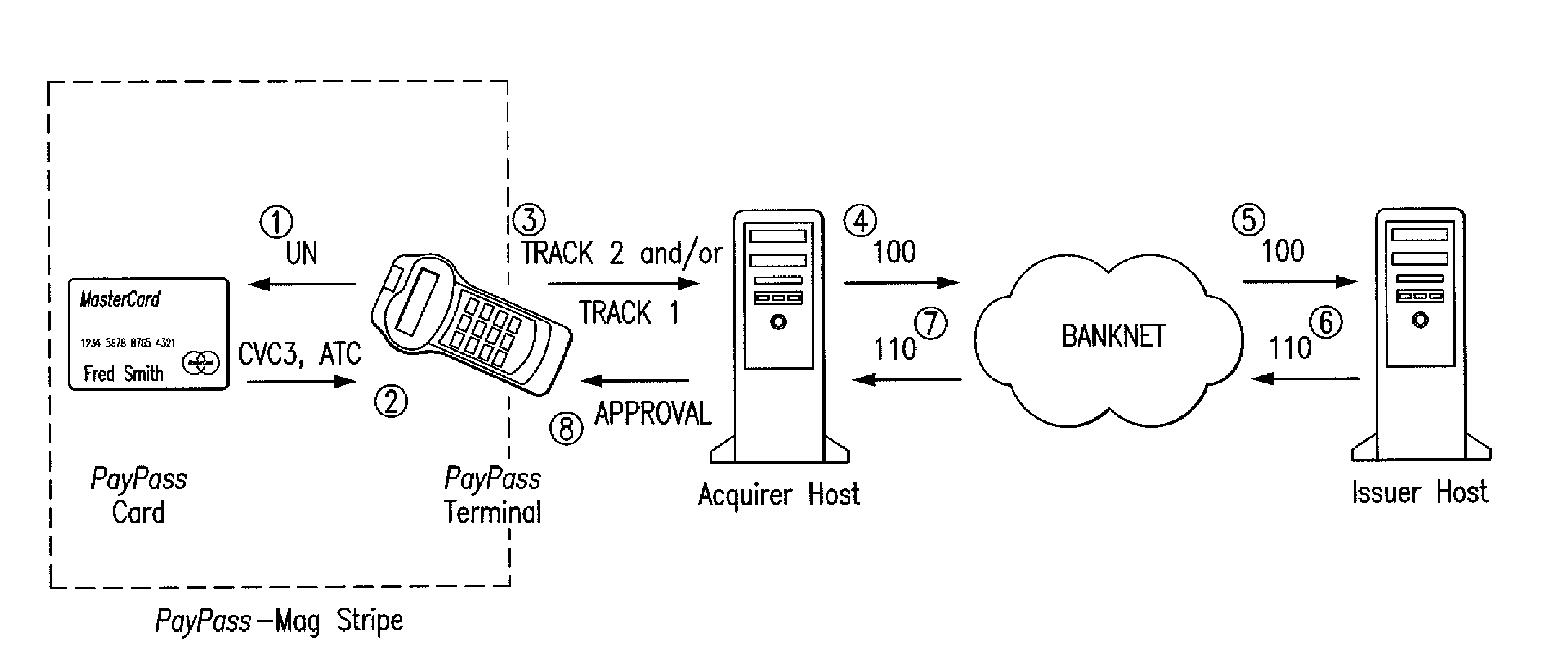

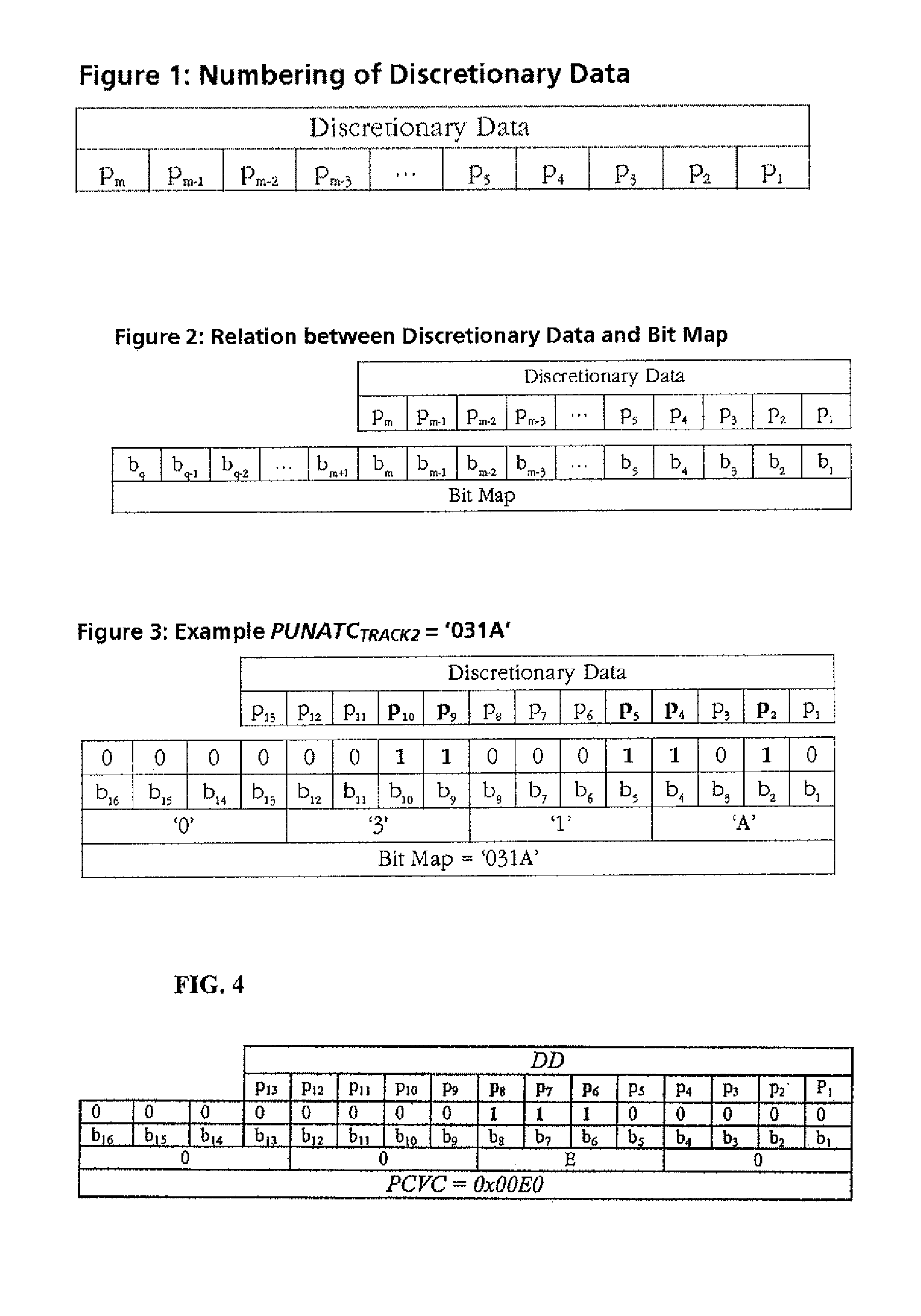

Method and system using a bitmap for passing contactless payment card transaction variables in standardized data formats

Owner:MASTERCARD INT INC

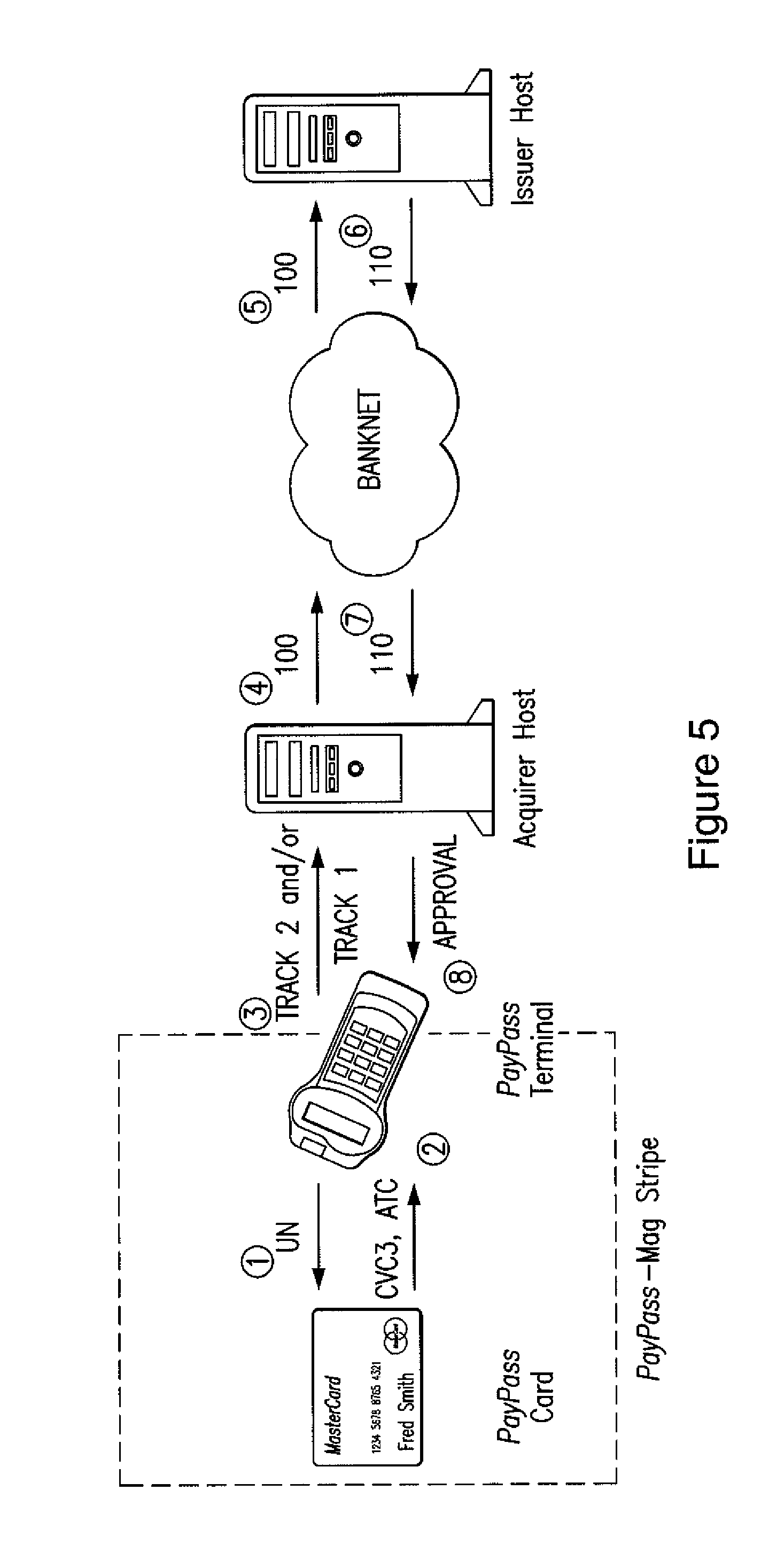

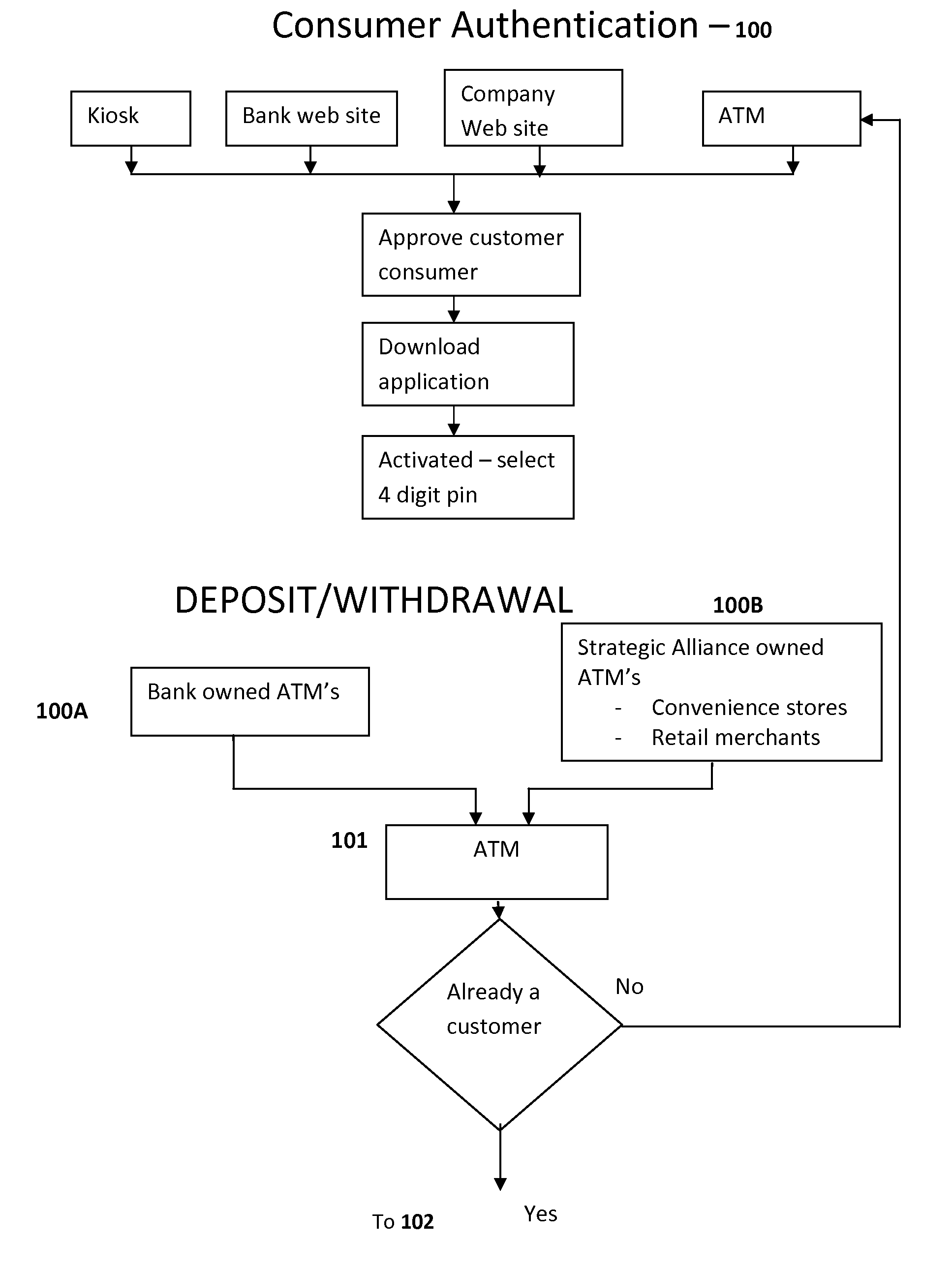

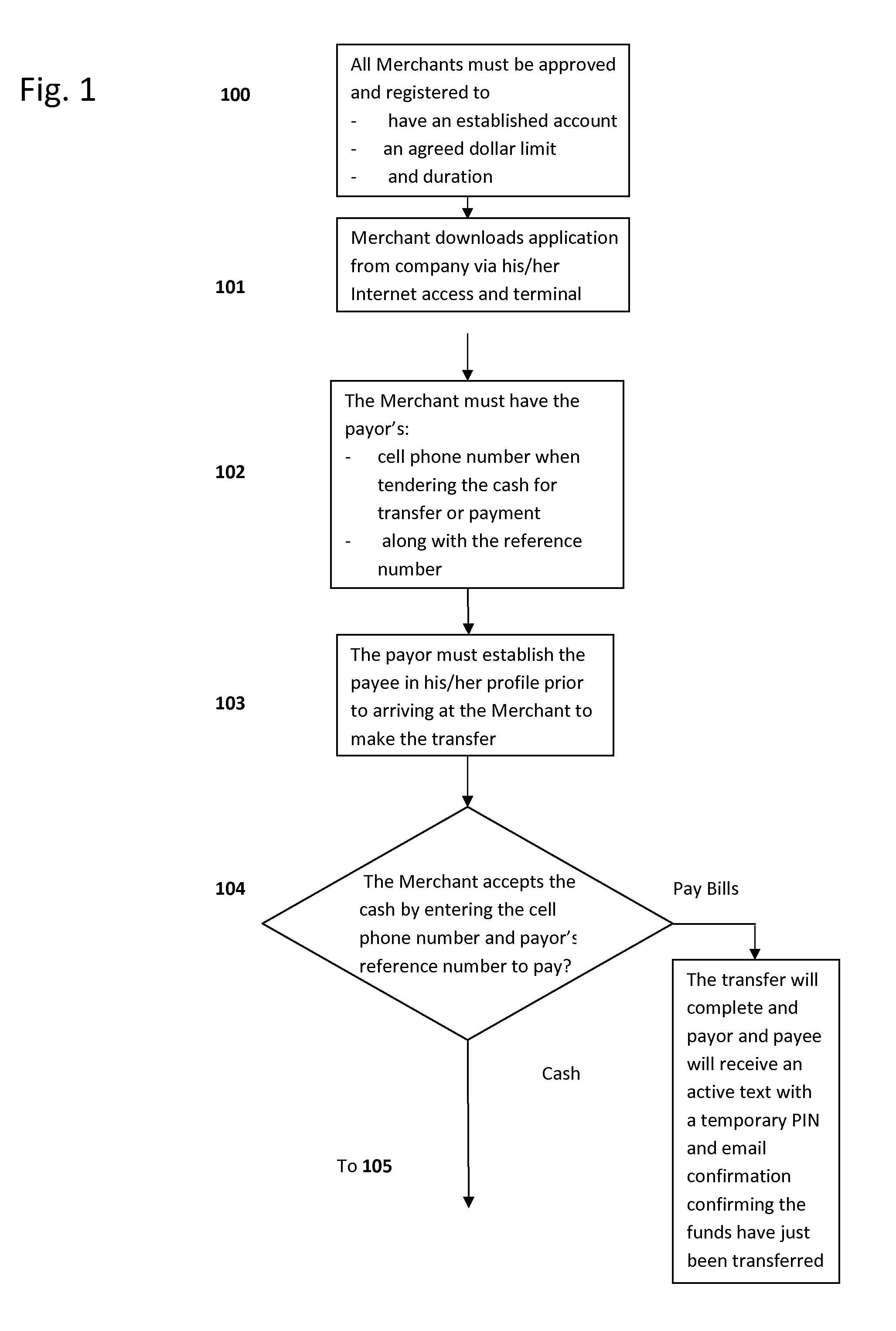

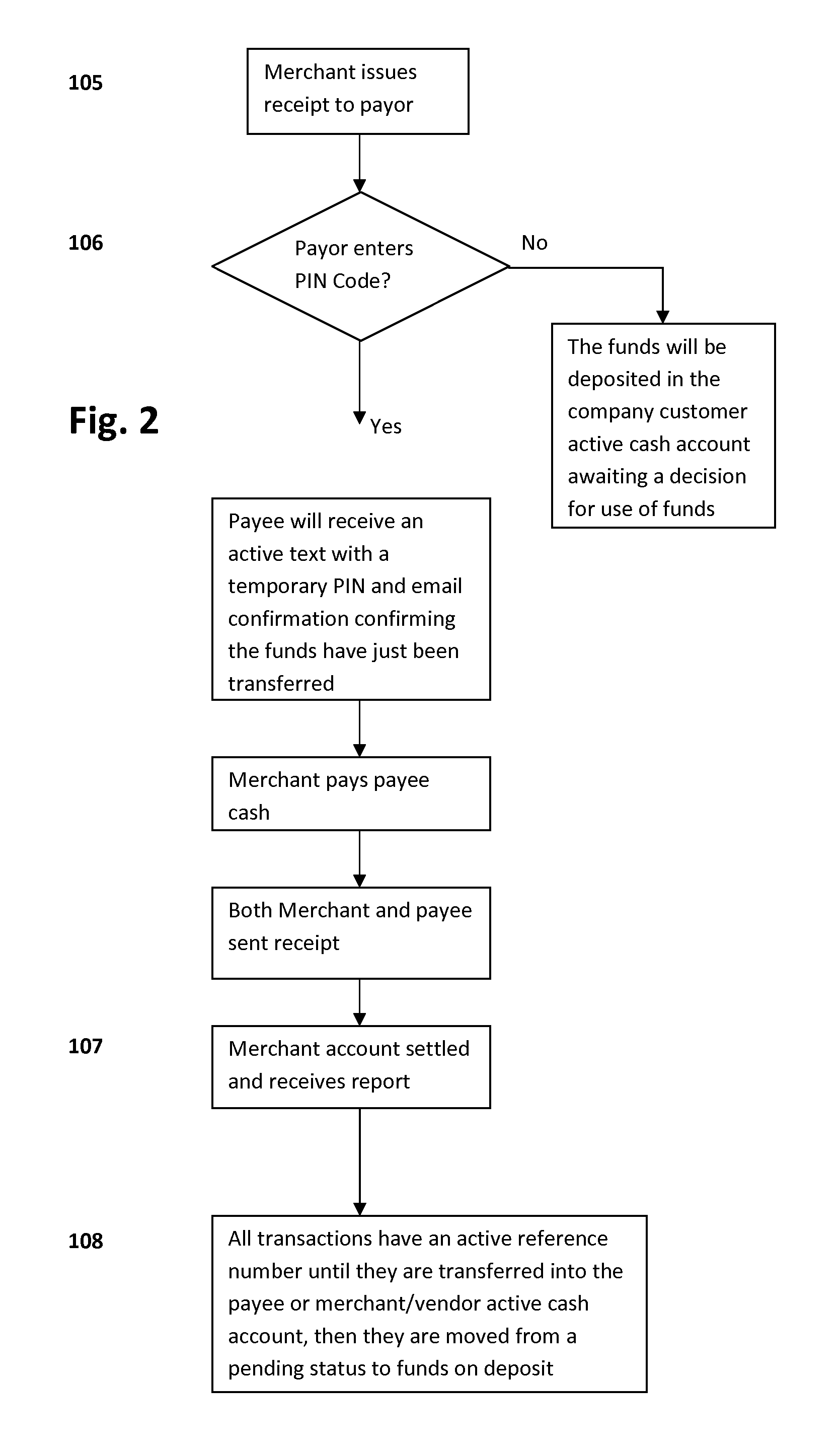

ATM/KIOSK Cash Acceptance

In one aspect, this invention relates to a new method for using a mobile telephone, in conjunction with a payment transaction server, as an authentication and cash payment device of a cash deposit made into an ATM / KIOSK for a variety of financial transactions where a cash payment is desired. Further, the transaction systems and methods for mobile telephone devices described herein allow a mobile telephone to participate in payment transactions in a manner that helps prevent identify theft and without relying on transferring amounts to / from one stored value account to another. It is emphasized that this abstract is provided to enable a searcher to quickly ascertain the subject matter of the technical disclosure and is submitted with the understanding that it will not be used to interpret or limit the scope or meaning of the claims.

Owner:GLOBAL 1 ENTERPRISES

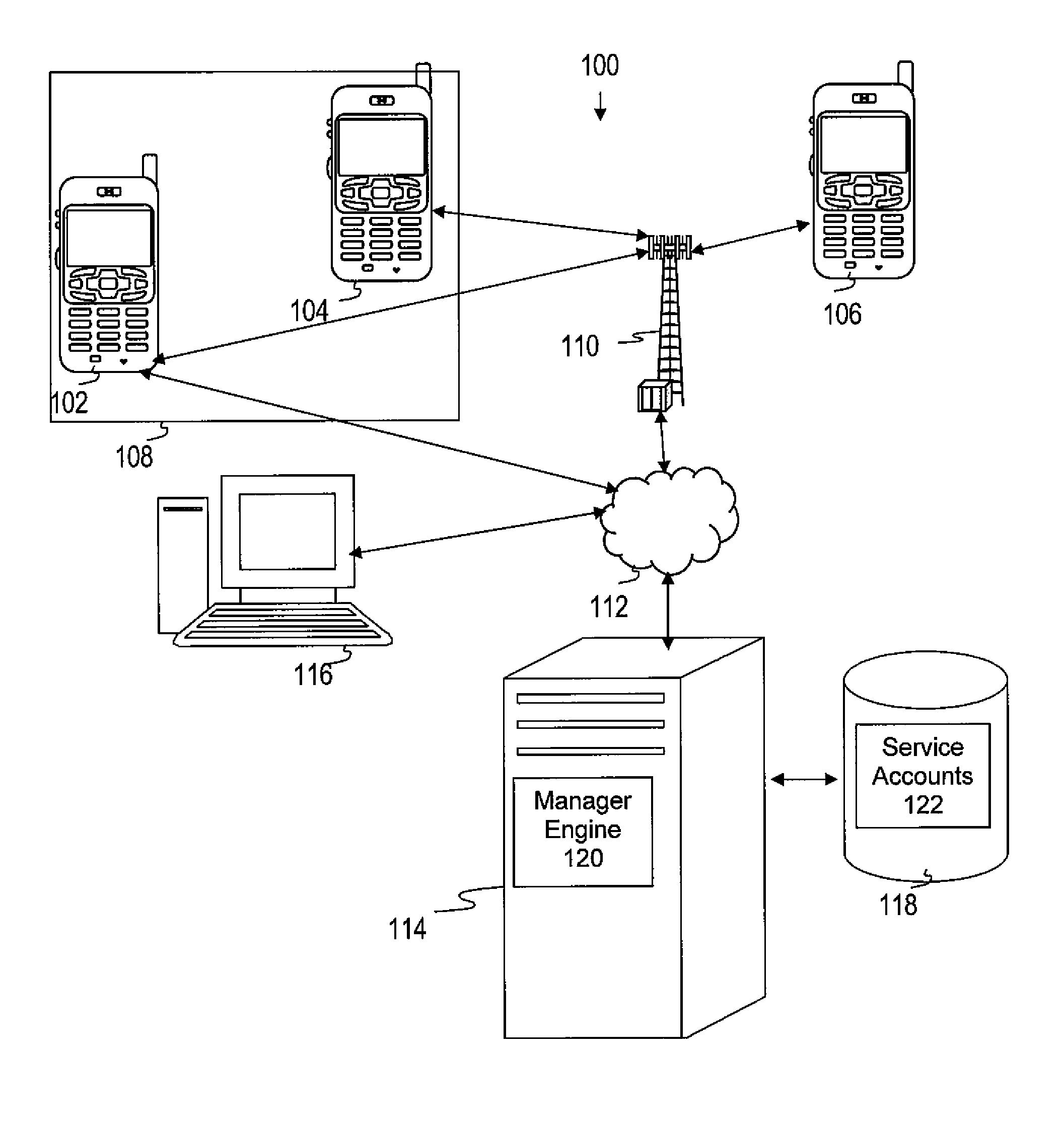

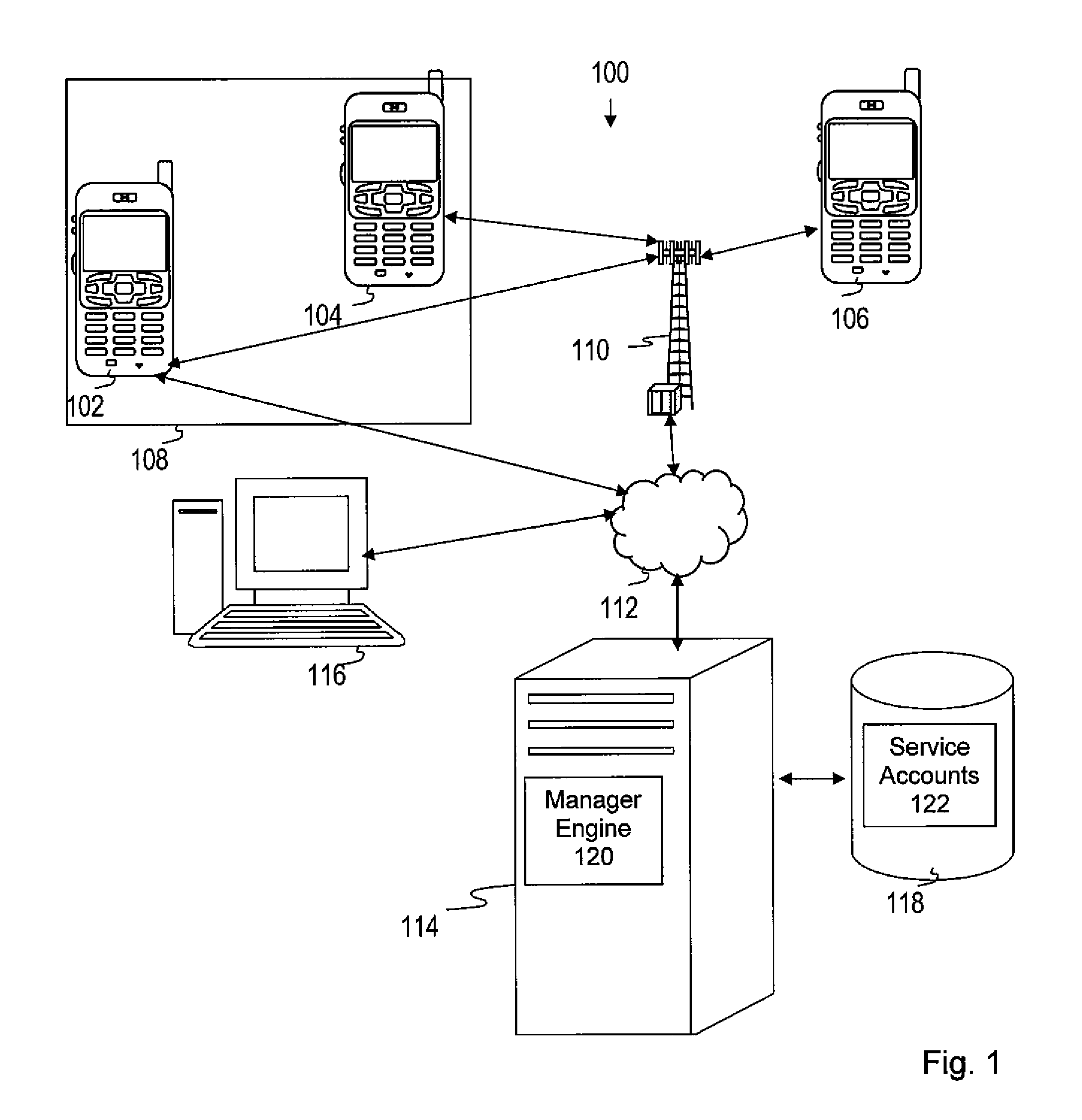

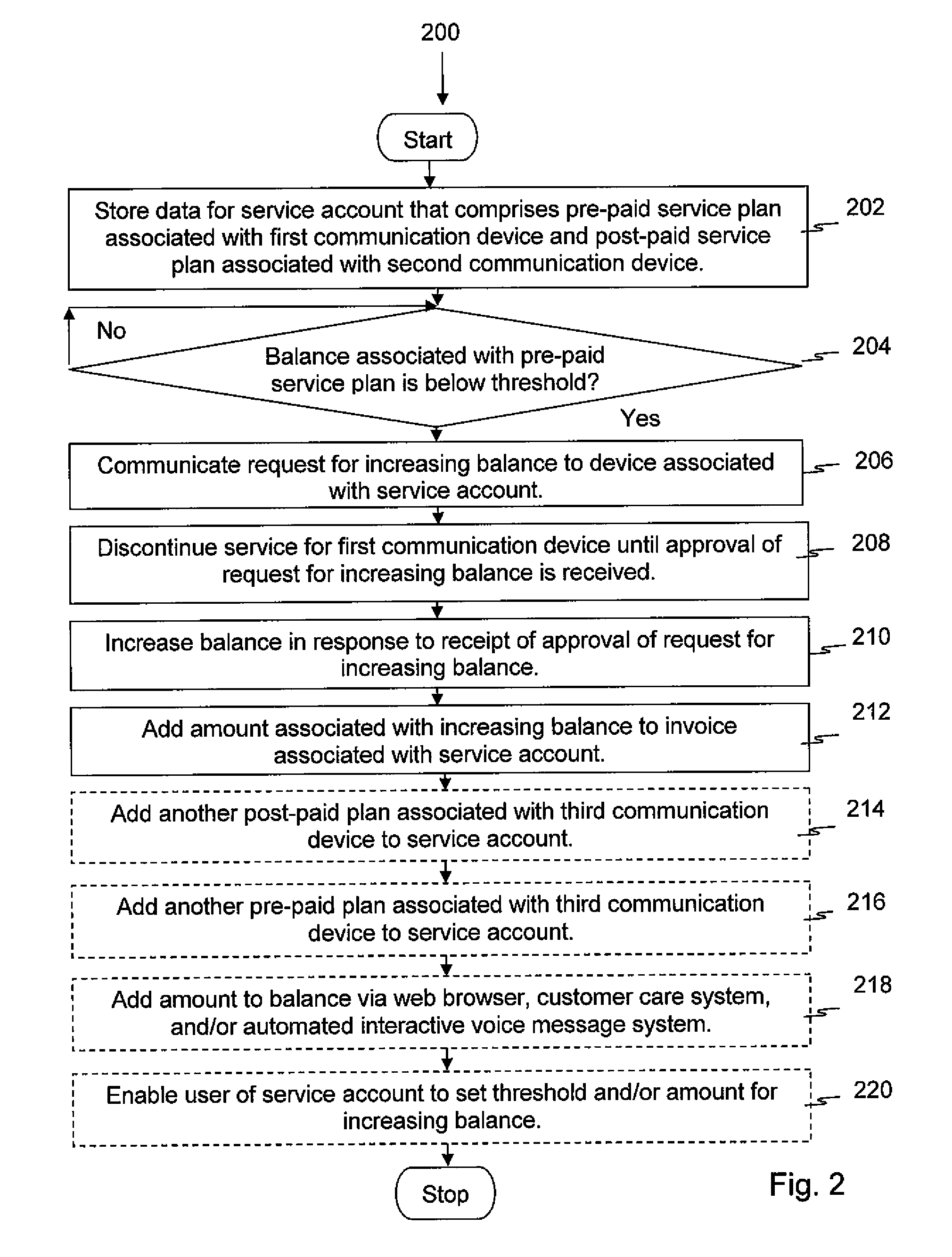

Pre and post-paid service plan manager

A service plan manager is provided, including a manager engine and a storage device to store data for a service account that comprises a pre-paid service plan associated with a first communication device and a post-paid service plan associated with a second communication device. The manager engine determines whether a balance associated with the pre-paid service plan is below a threshold, and communicates a request for increasing the balance to a device associated with the service account if the balance associated with the pre-paid service plan is below the threshold. The manager engine discontinues service for the first communication device until an approval of the request for increasing the balance is received, increases the balance in response to a receipt of the approval of the request for increasing the balance, and adds an amount associated with increasing the balance to an invoice associated with the service account.

Owner:T MOBILE INNOVATIONS LLC

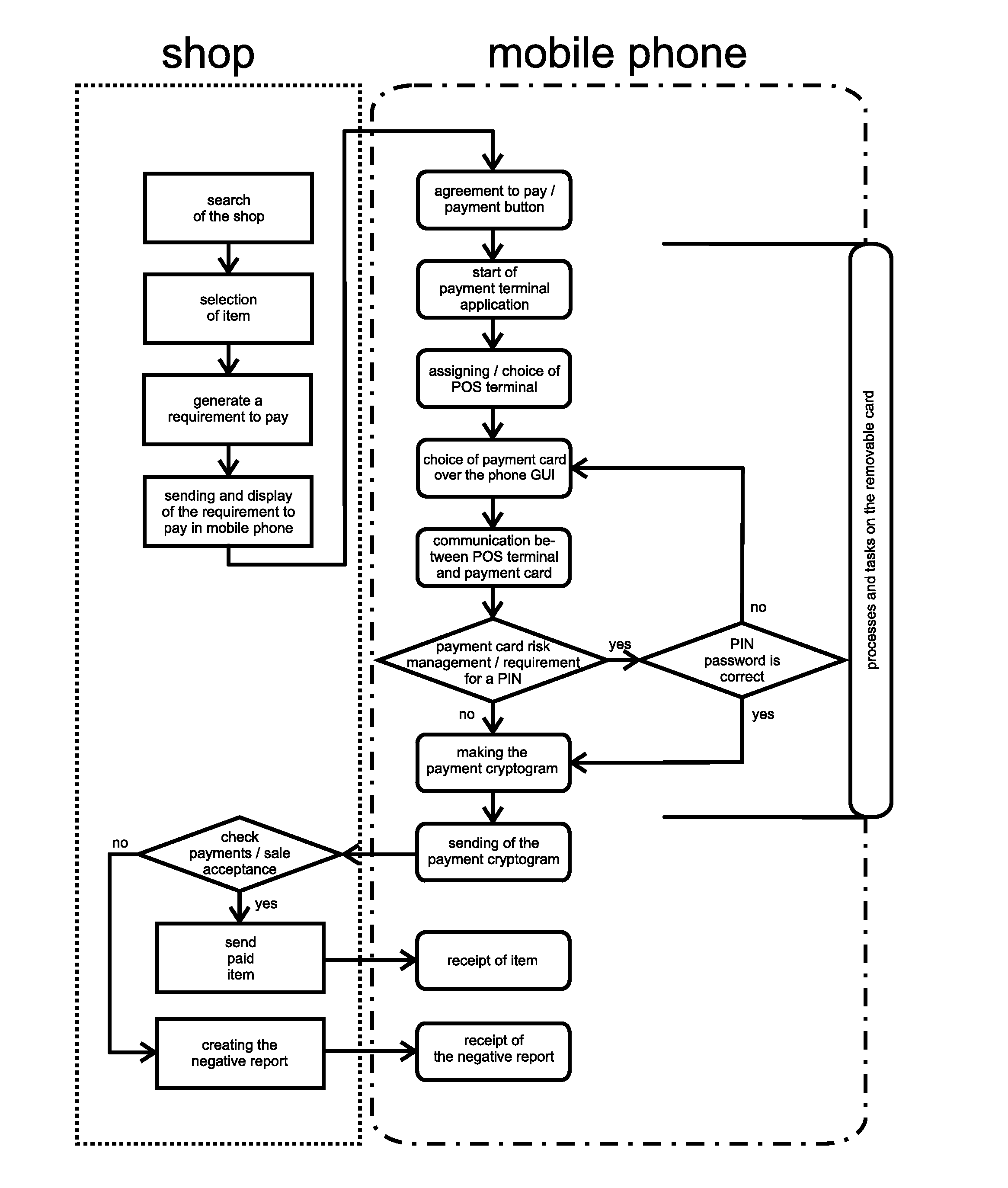

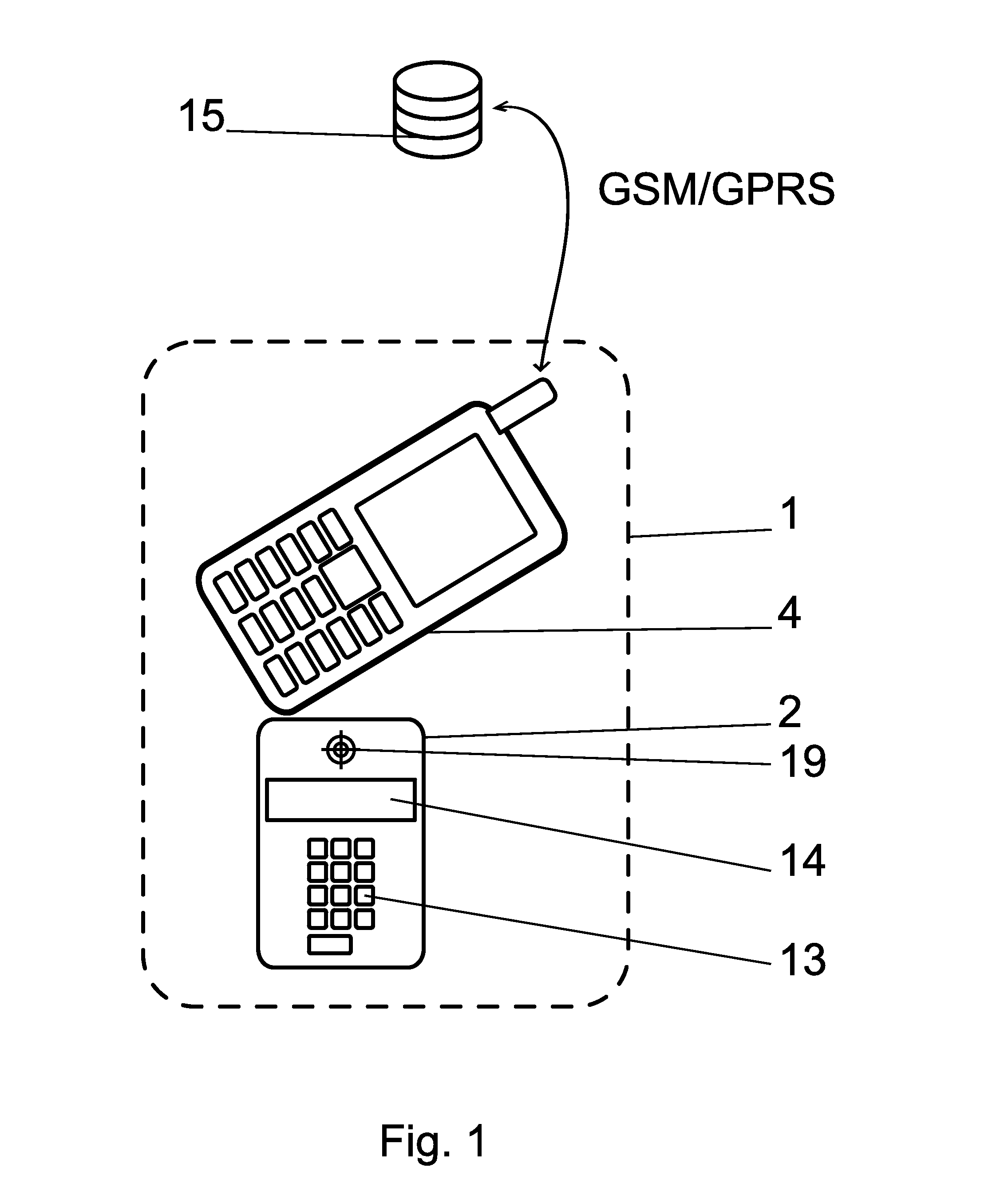

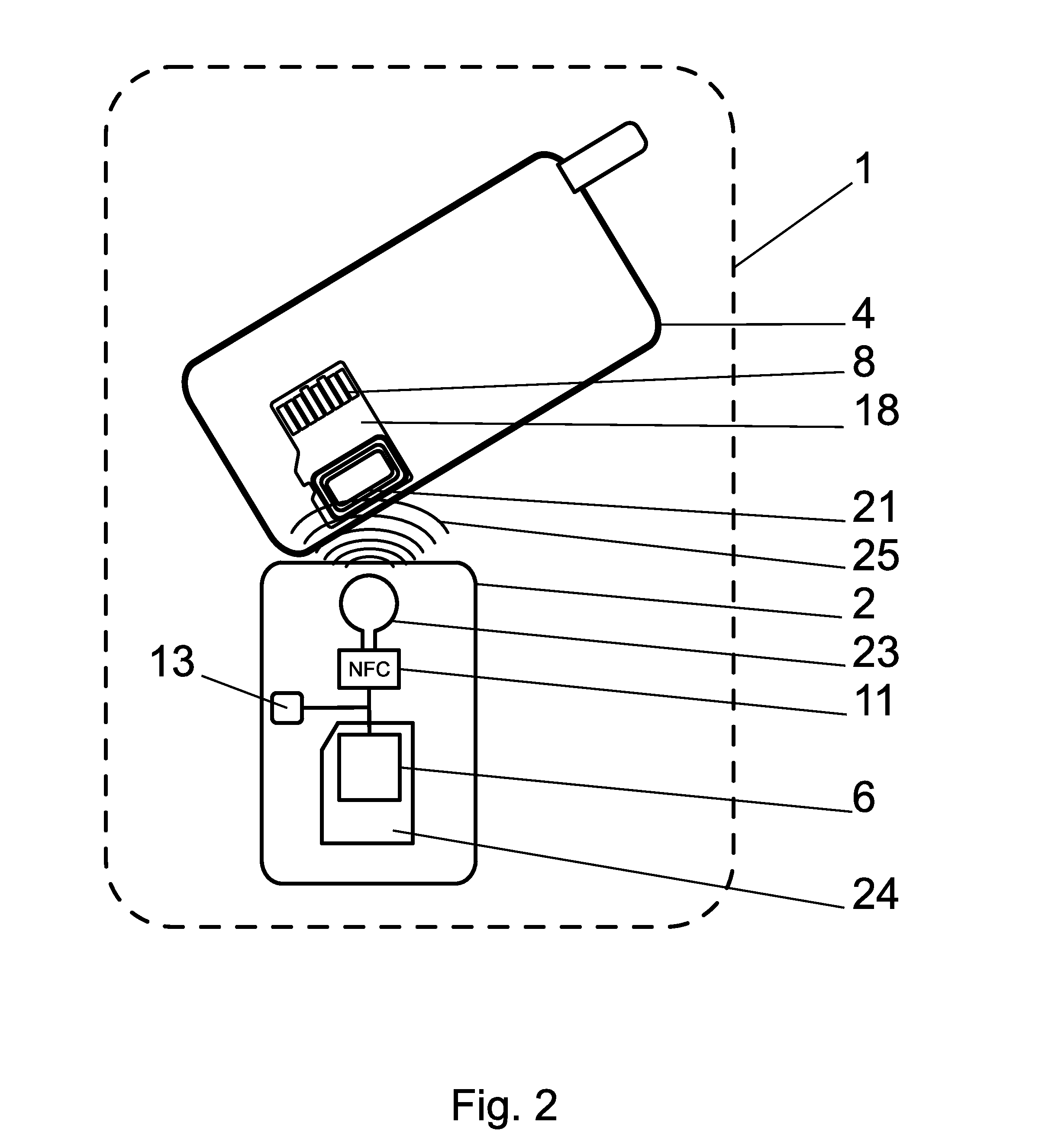

POS payment terminal and a method of direct debit payment transaction using a mobile communication device, such as a mobile phone

InactiveUS20110112968A1Solve insufficient capacityImprove security levelAcutation objectsAccounting/billing servicesDirect debitPayment transaction

A payment terminal using a mobile communication device (4), such as a mobile phone, is located on a removable memory card (1), e.g. type microSD card, which is adjusted in such a way so it can be inserted into an additional hardware slot, e.g. memory slot. A payment POS terminal application runs on a removable memory card (1), which contains at least one payment card. The payment card's unit (7) with the card's payment application is located in the secured part of the memory, separately from the terminal's configuration data unit (6). The configuration data of the terminal's selected identity and the payment card's data are located in the separate parts of the secure element or in completely independent secure elements or they can also be localized in the Sales Device of the merchant and there e.g. within the ICC card (29) or SAM card (42).

Owner:SMK CORP

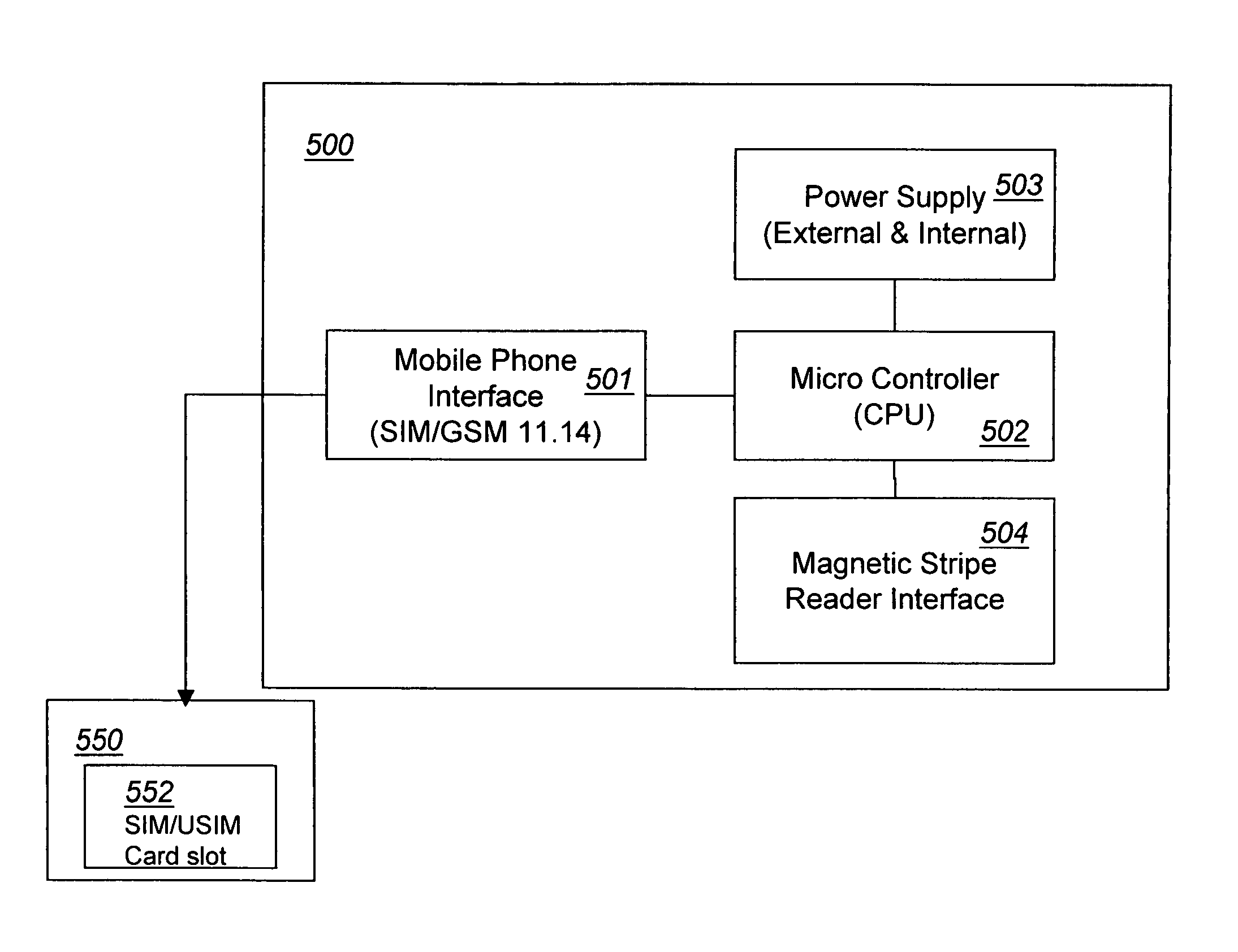

Mobile communication device equipped with a magnetic stripe reader

InactiveUS7336973B2Credit registering devices actuationAccounting/billing servicesElectricityComputer module

A wireless mobile device is adapted to access a wireless network and includes a subscriber identification module (SIM) card slot and a magnetic stripe reader module electrically connected to the SIM card slot and thereby to the wireless mobile phone. The magnetic stripe reader module is adapted to receive and read information stored in a magnetic stripe and transmit this information to an entity through the wireless mobile device and the wireless network. The wireless mobile device of this invention is used to conduct financial transactions using a payment card comprising a magnetic stripe. The financial transactions include face-to-face or remote purchases and payment with the payment card through a financial institution.

Owner:VERIFONE INC

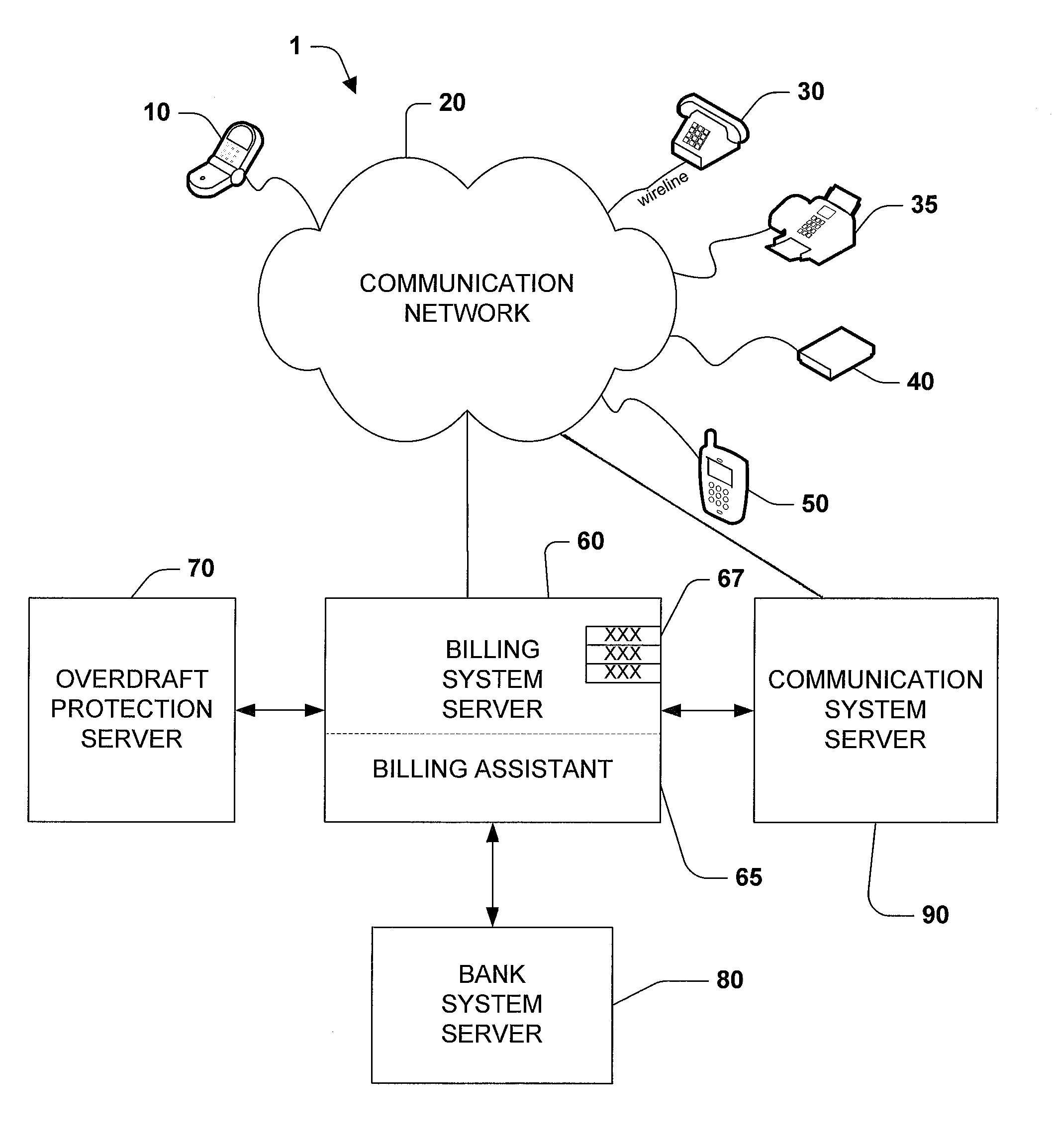

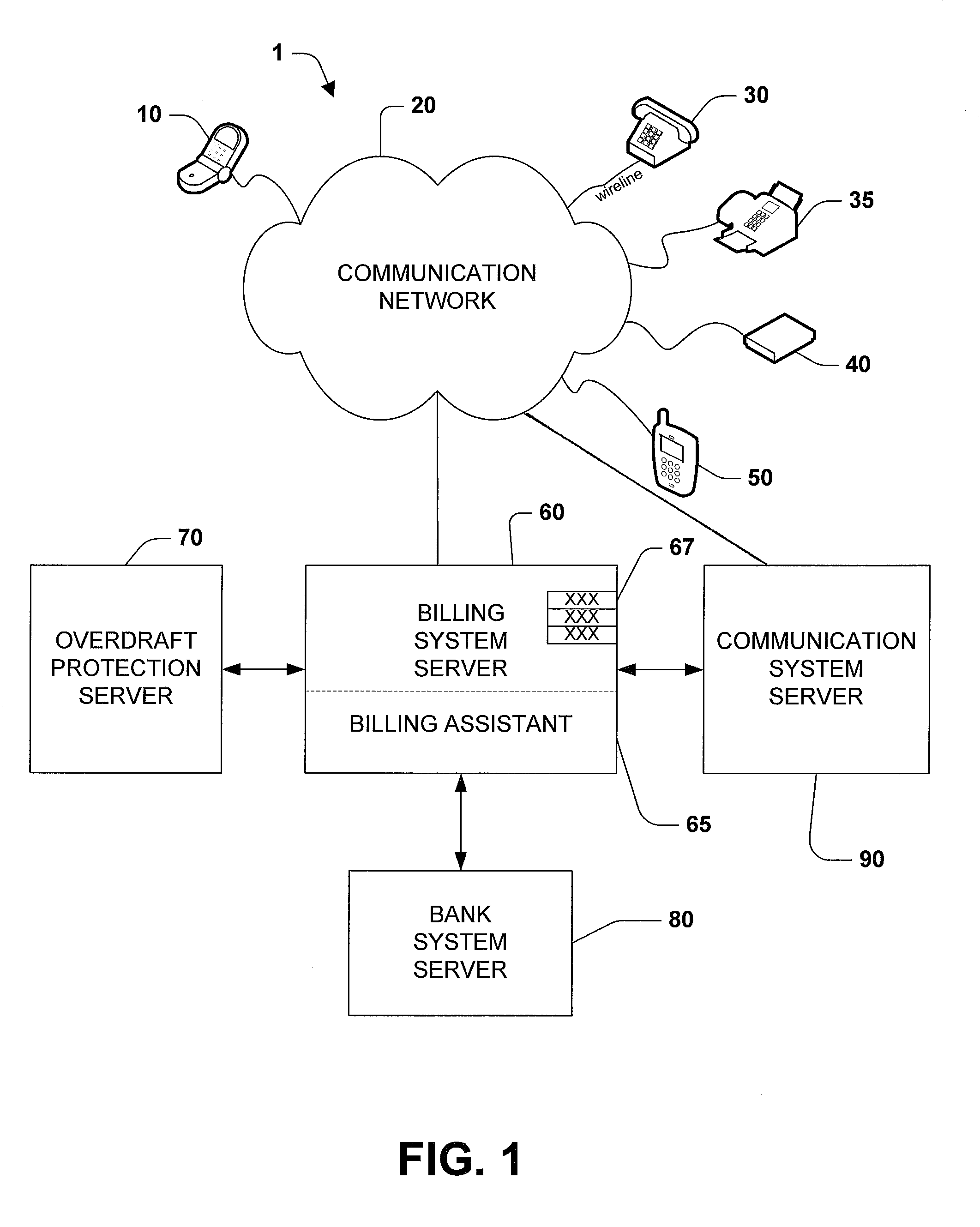

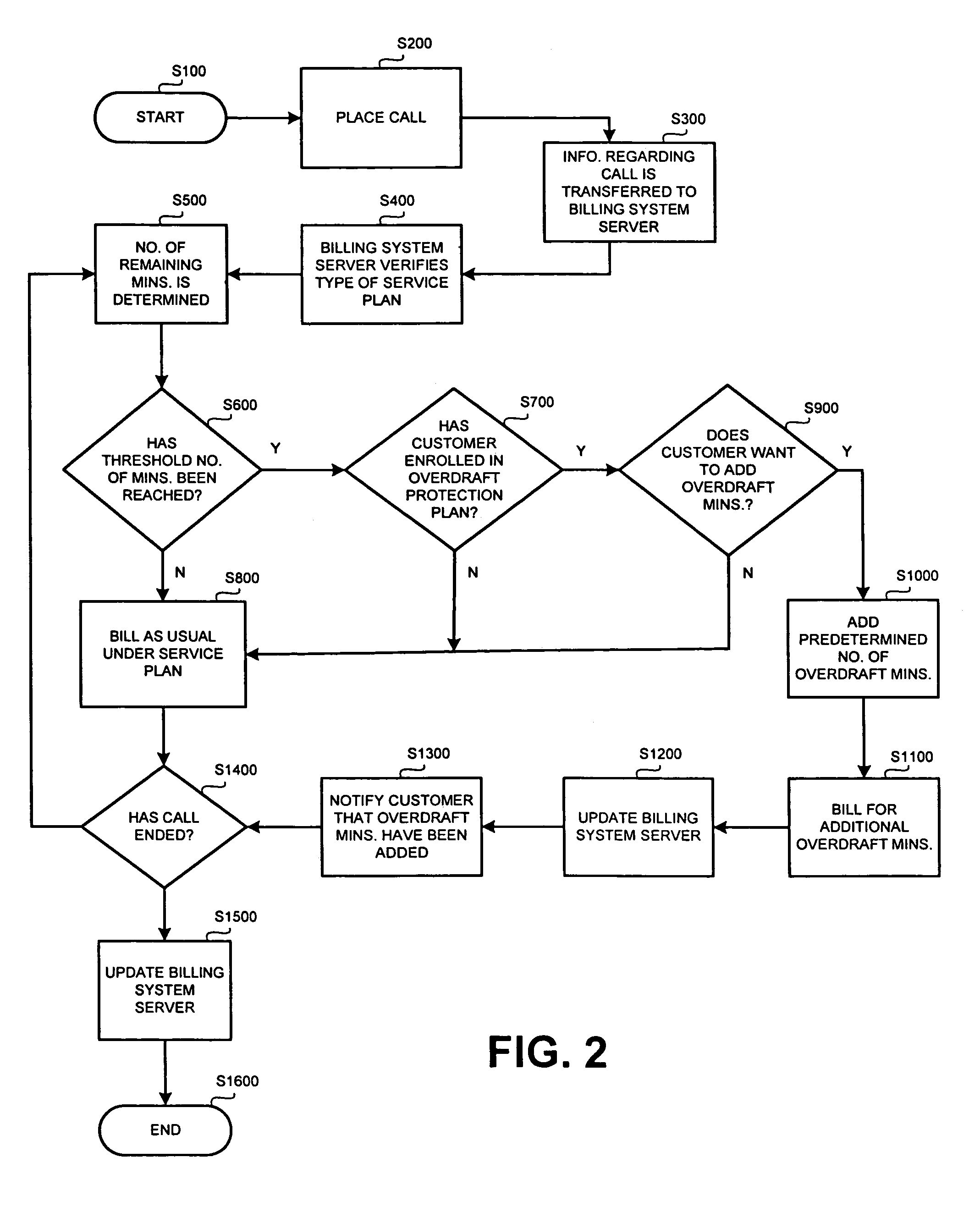

Methods for providing overdraft protection for post-paid communication service plans

ActiveUS7450928B1Cost controlIncreased overage costMetering/charging/biilling arrangementsAccounting/billing servicesCommunication PlanIndustrial engineering

Methods for adding minutes to a calling plan having a calling plan period. The methods including determining whether a threshold number of minutes have been reached during the calling plan period; and incrementally adding minutes to the calling plan when the threshold number of minutes has been reached. The cost per minute of the added minutes is less than the high-cost per minute rate normally associated with exceeding the threshold number of minutes during the calling plan period.

Owner:CINGULAR WIRELESS II LLC

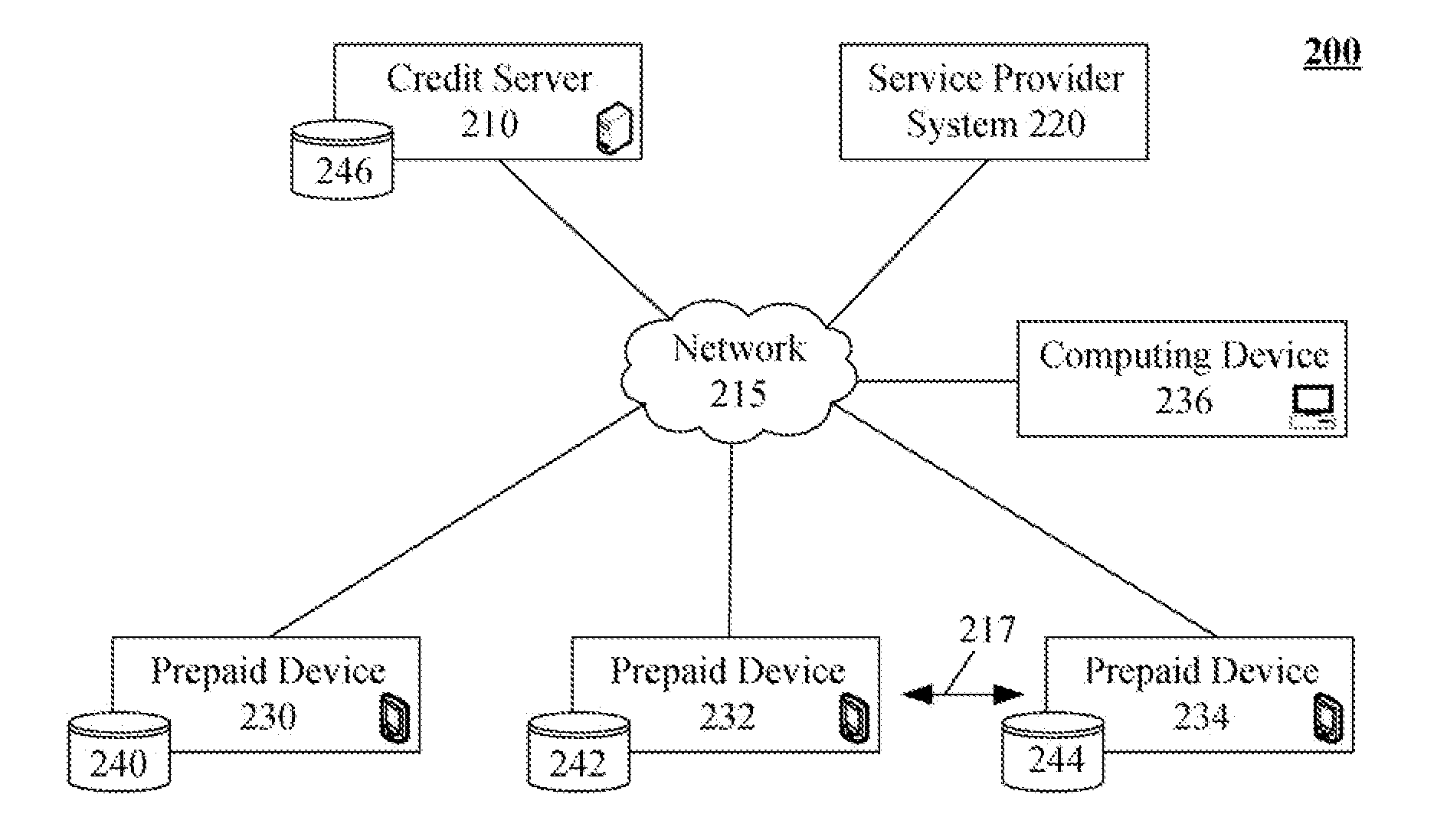

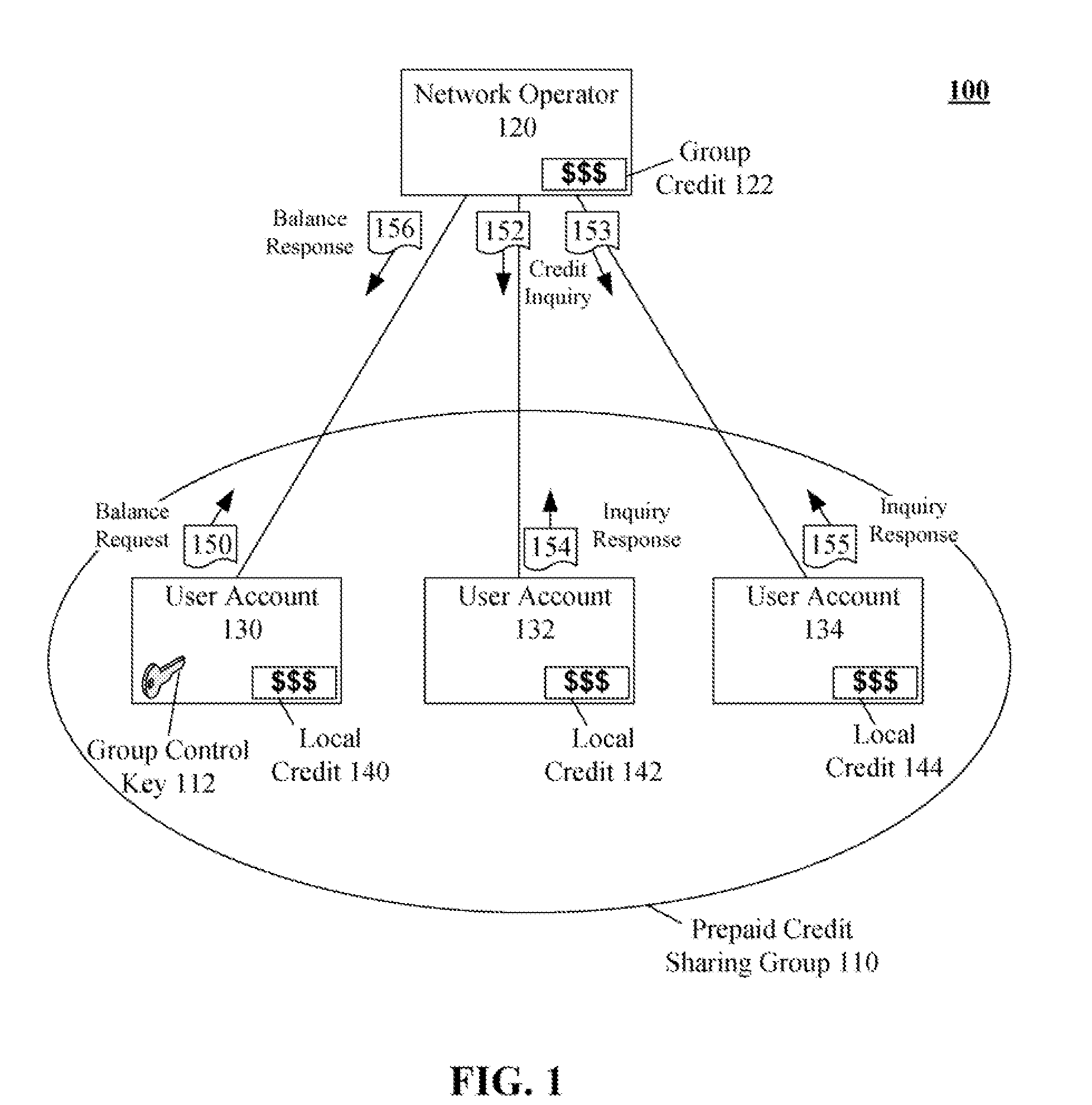

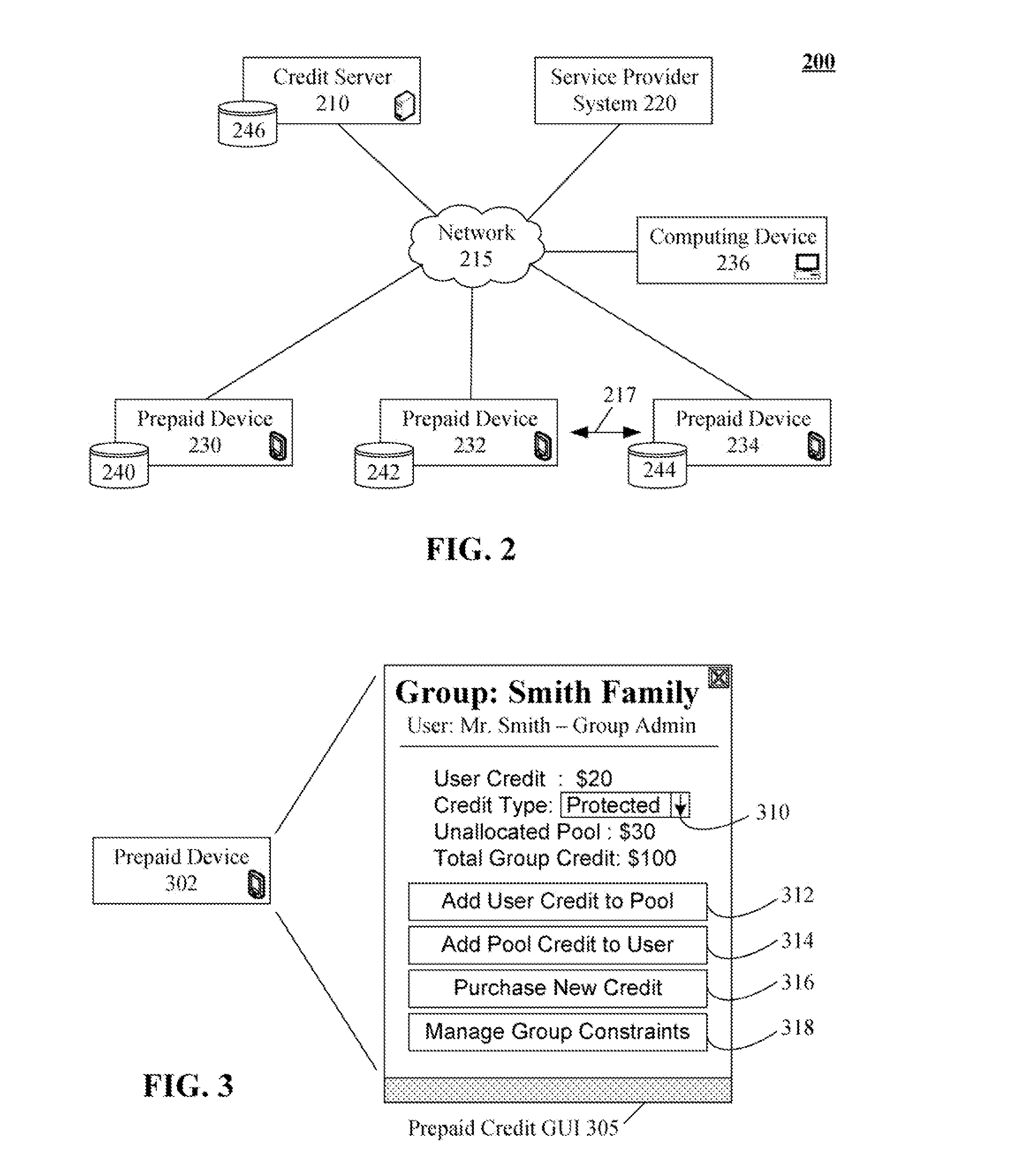

Sharing prepaid mobile telephony credit among a group

InactiveUS20080119162A1Accounting/billing servicesCoin/check-freed systemsComputer scienceData science

The present invention discloses a concept of a prepaid credit sharing group that includes a set of prepaid user accounts. A prepaid credit pool can be established for members of the prepaid group, where each group member is able to use credit from the pool and / or contribute credit to the pool. Group members can submit queries to dynamically determine credit balances available to the group. The prepaid group and individual accounts within the group can be centrally managed by an authorized group administrator. This administrator can also have authority to establish limitations and policies that are enforced for all group members.

Owner:MOTOROLA MOBILITY LLC

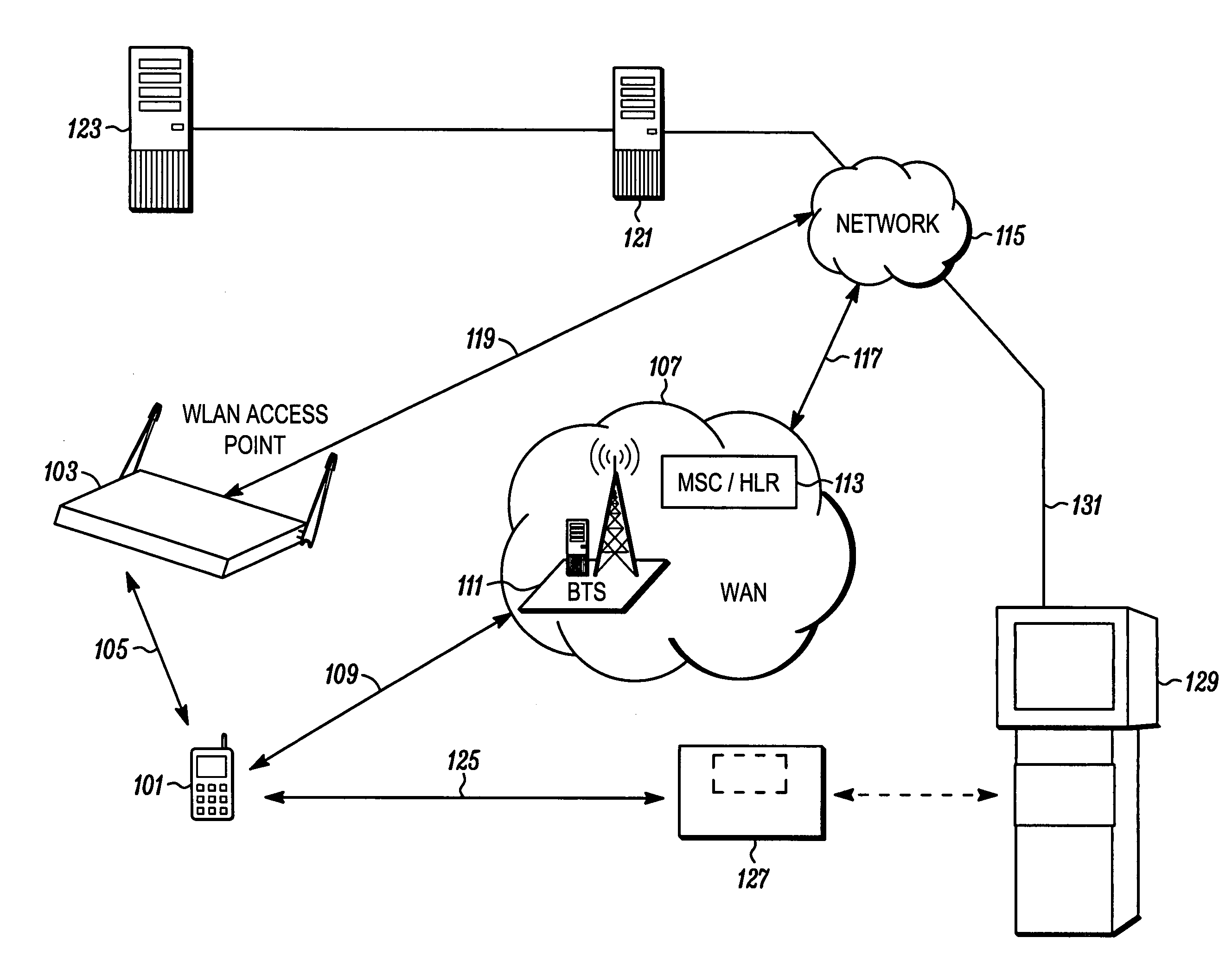

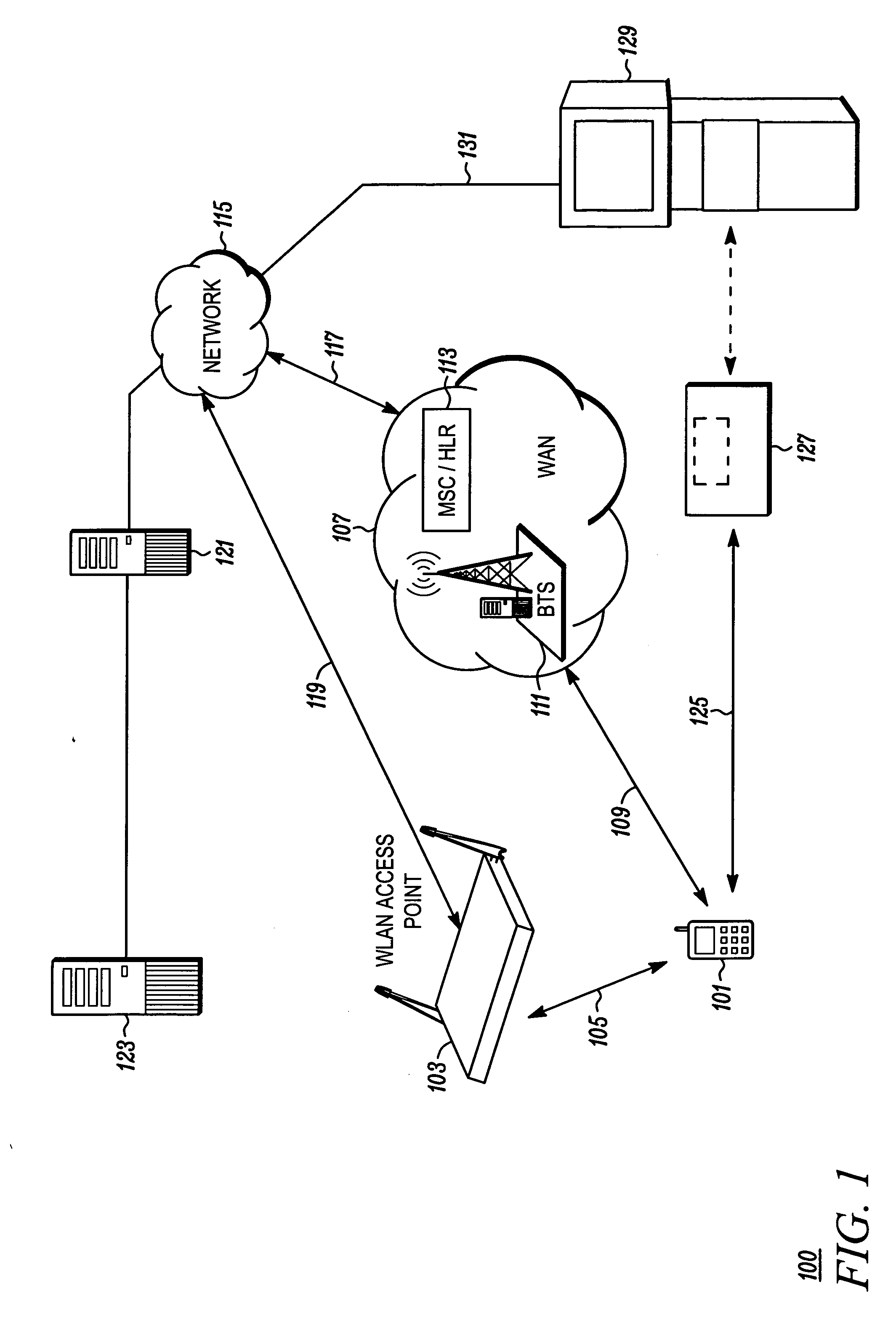

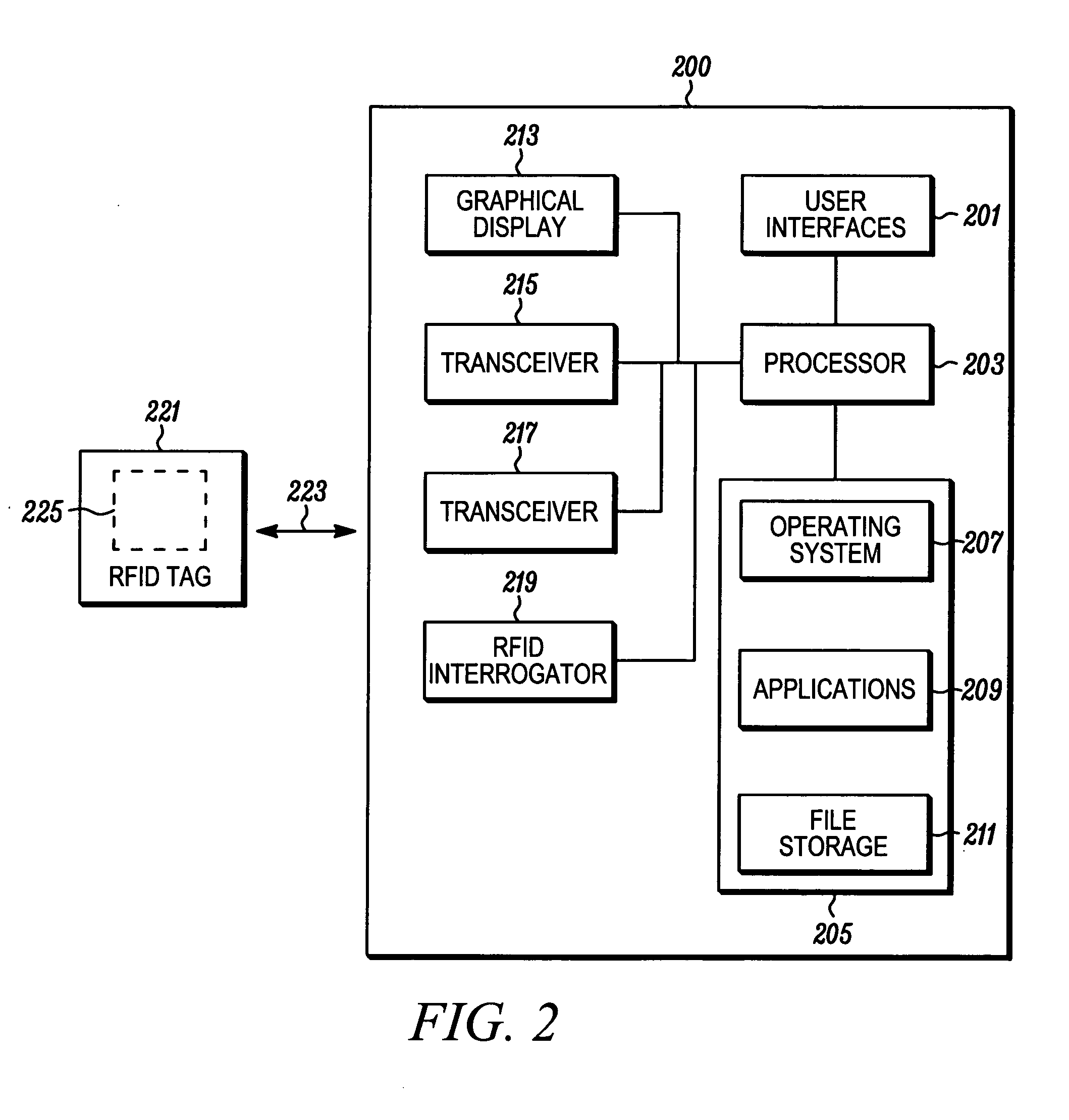

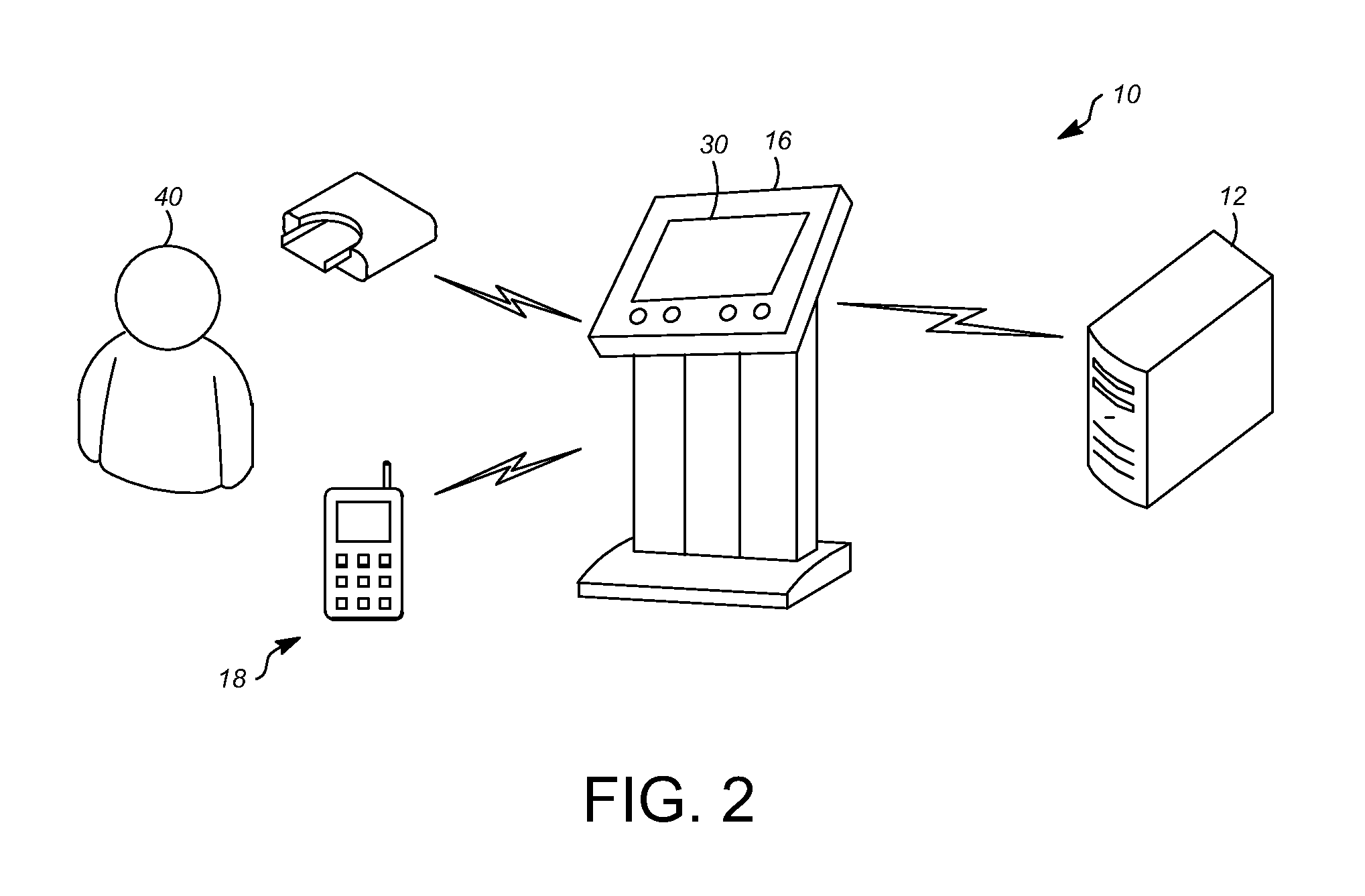

Mobile station service applications using service kiosk with transponder

InactiveUS20060094405A1Data processing applicationsSpecial service for subscribersComputer networkWireless lan

In a first embodiment of the present invention, a mobile station (101) interrogates an RFID tag (127) located on a service kiosk (129) and receives data. The mobile station (101) parses the data to obtain a server (123) address and information identifying a service offered by the kiosk (129), and connects with the server (123) using a WLAN AP (103) or a wide are network (107). The mobile station (101) may then perform a transaction such as paying a parking fee, by interacting with an application or applet downloaded from the server (123). The server (123) can command the service kiosk (129) to perform an action such as printing out a receipt for the user.

Owner:MOTOROLA INC

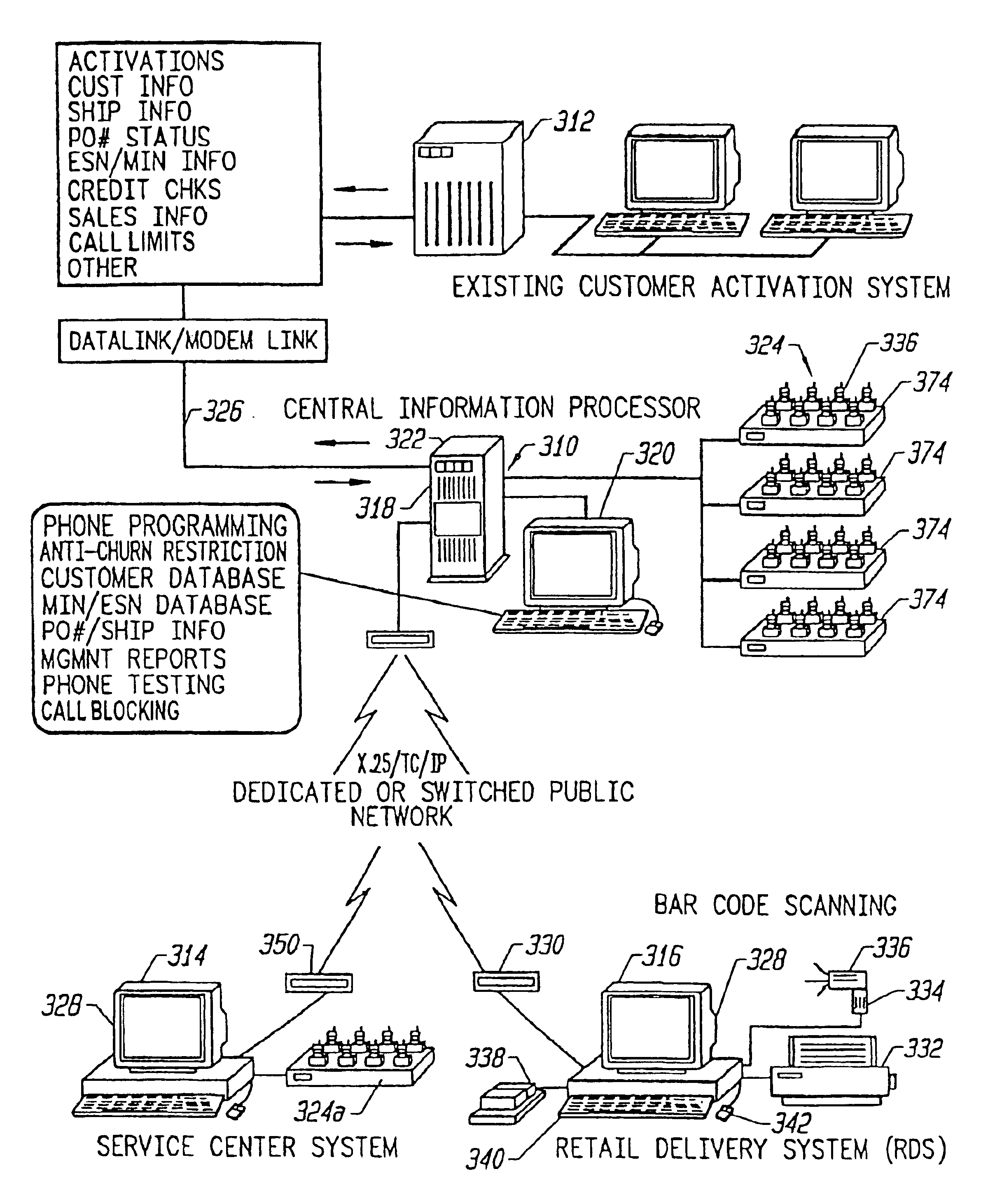

Mobile phone distribution system

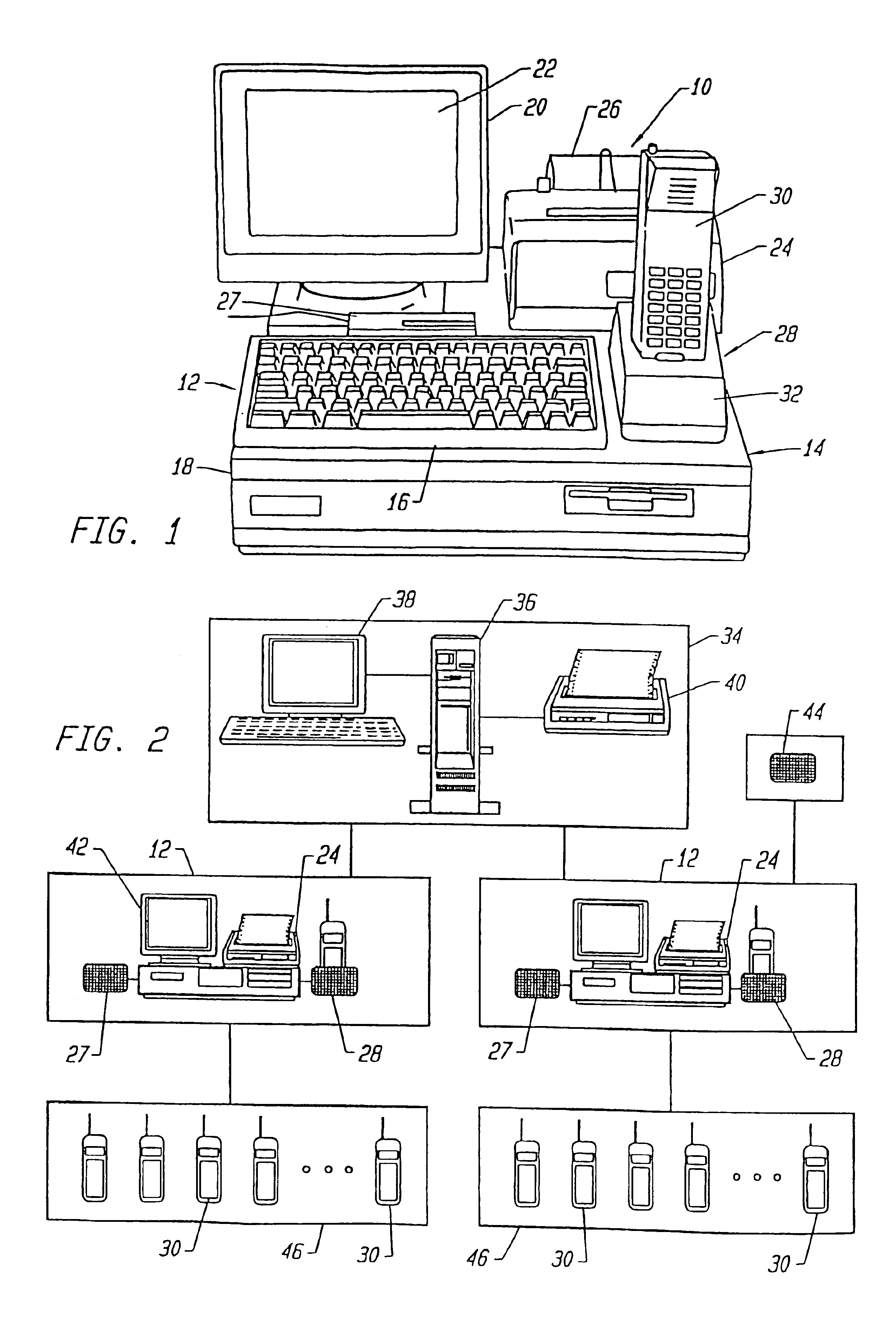

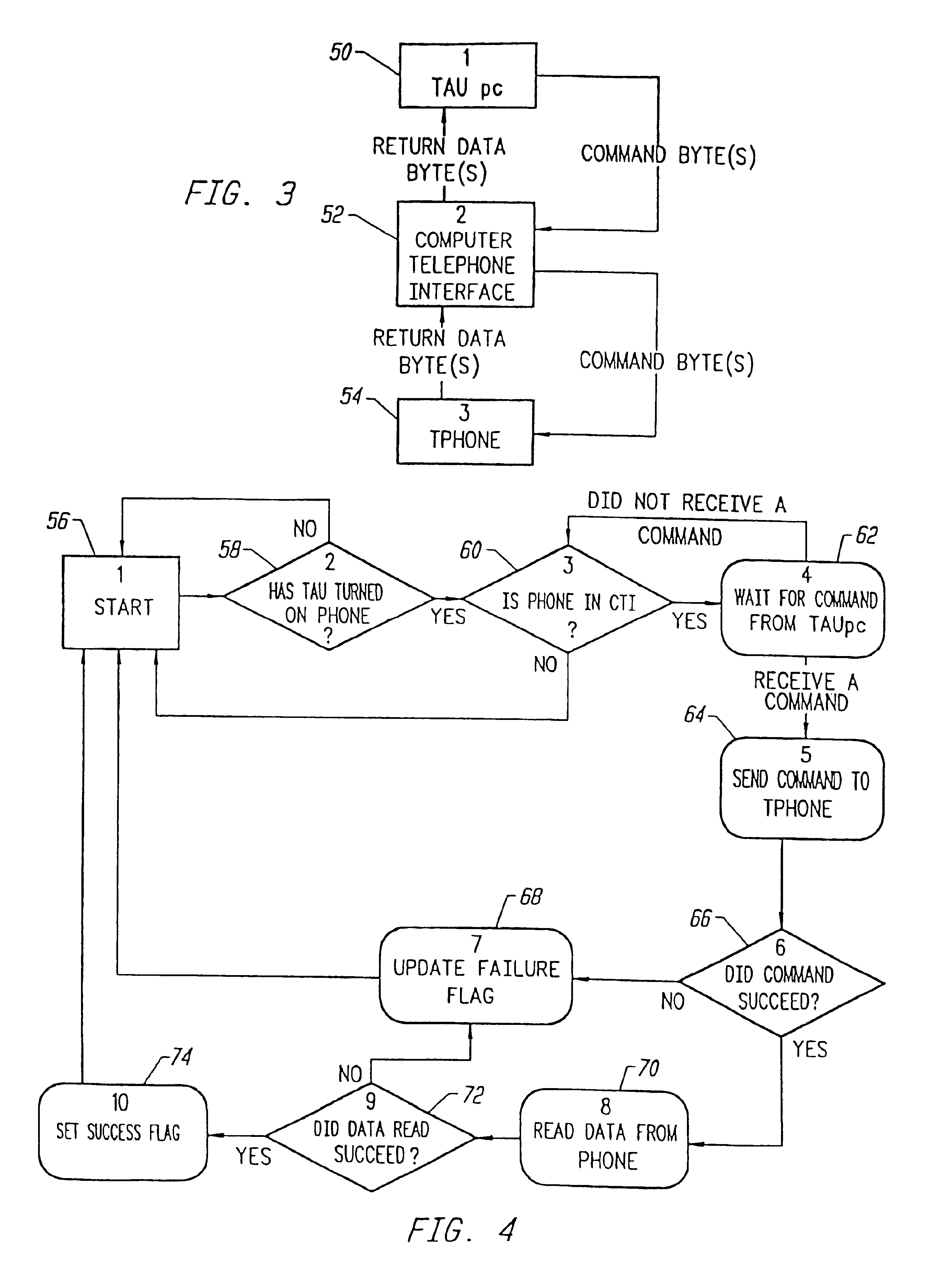

InactiveUS7058386B2Avoid switchingAvoid drudgeryAccounting/billing servicesUnauthorised/fraudulent call preventionCredit cardAutomatic programming

A mobile telephone programming and accounting system that includes an integrated hardware system interlinking a telephone unit, a telephone interlink receiver, and a central processing unit connected to the interlink receiver. The hardware system also preferably includes a receipt printer and a credit card reader. The telephone unit is preferably equipped with an internal real time clock and calendar circuit and memory store to record the time and date of calls for reporting to the central processing unit to enable tracking and detailed accounting of calls. The interlink receiver in the improved design includes a gang platform for programming multiple phone units, which may be phone units of different manufacturers, and provides for automatic programming of the multiple units and, in the retail distribution setting, programming the operating parameters and assignment of the phone unit to a service provider with encryption keys to reduce service churning.

Owner:TRACFONE WIRELESS

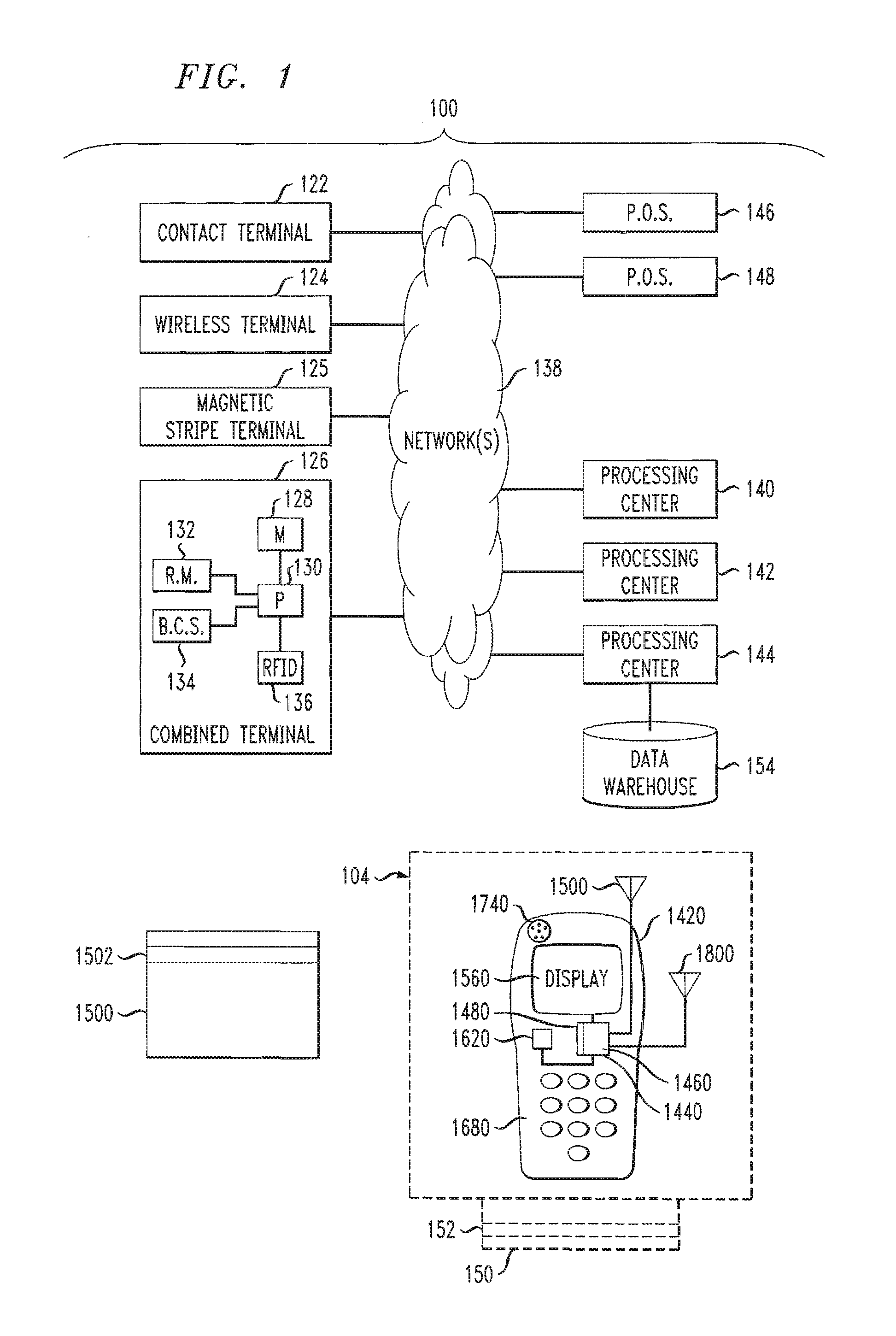

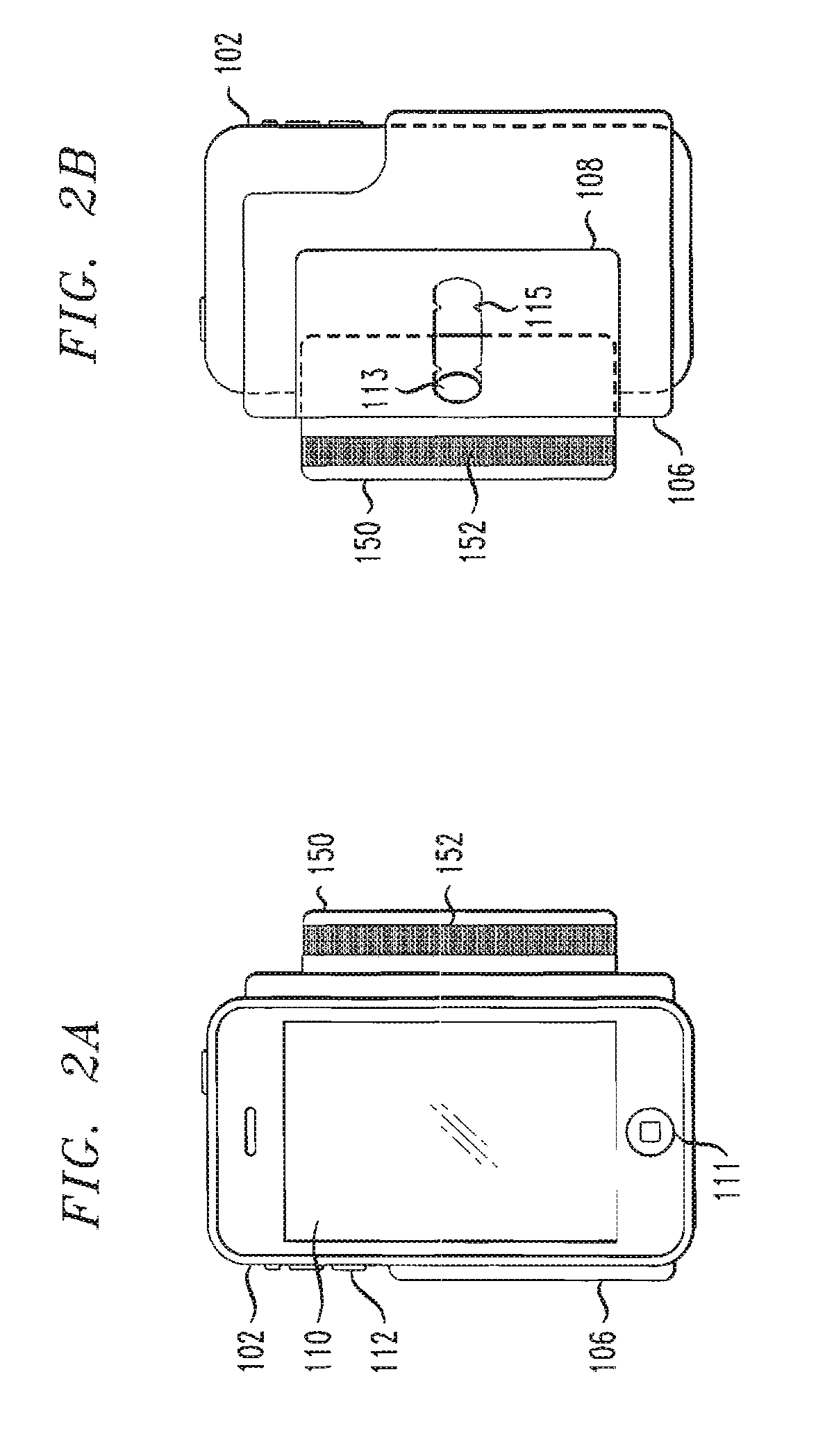

Magnetic stripe attachment and application for mobile electronic devices

InactiveUS20120270528A1Easy to useConfidenceAccounting/billing servicesPayment architectureComputer hardwareDisplay device

A mobile electronic device such as a mobile phone includes wallet application software for receiving, storing, encrypting, and transmitting selected payment card data. A tab including a programmable magnetic stripe is associated with a controller for receiving transmitted payment card data and programming the stripe with selected data. The tab is mounted directly to the electronic device or to an attachment device removably coupled to the electronic device. The attachment device may comprise a case for the mobile electronic device that allows access to a user interface and display of the mobile electronic device.

Owner:MASTERCARD INT INC

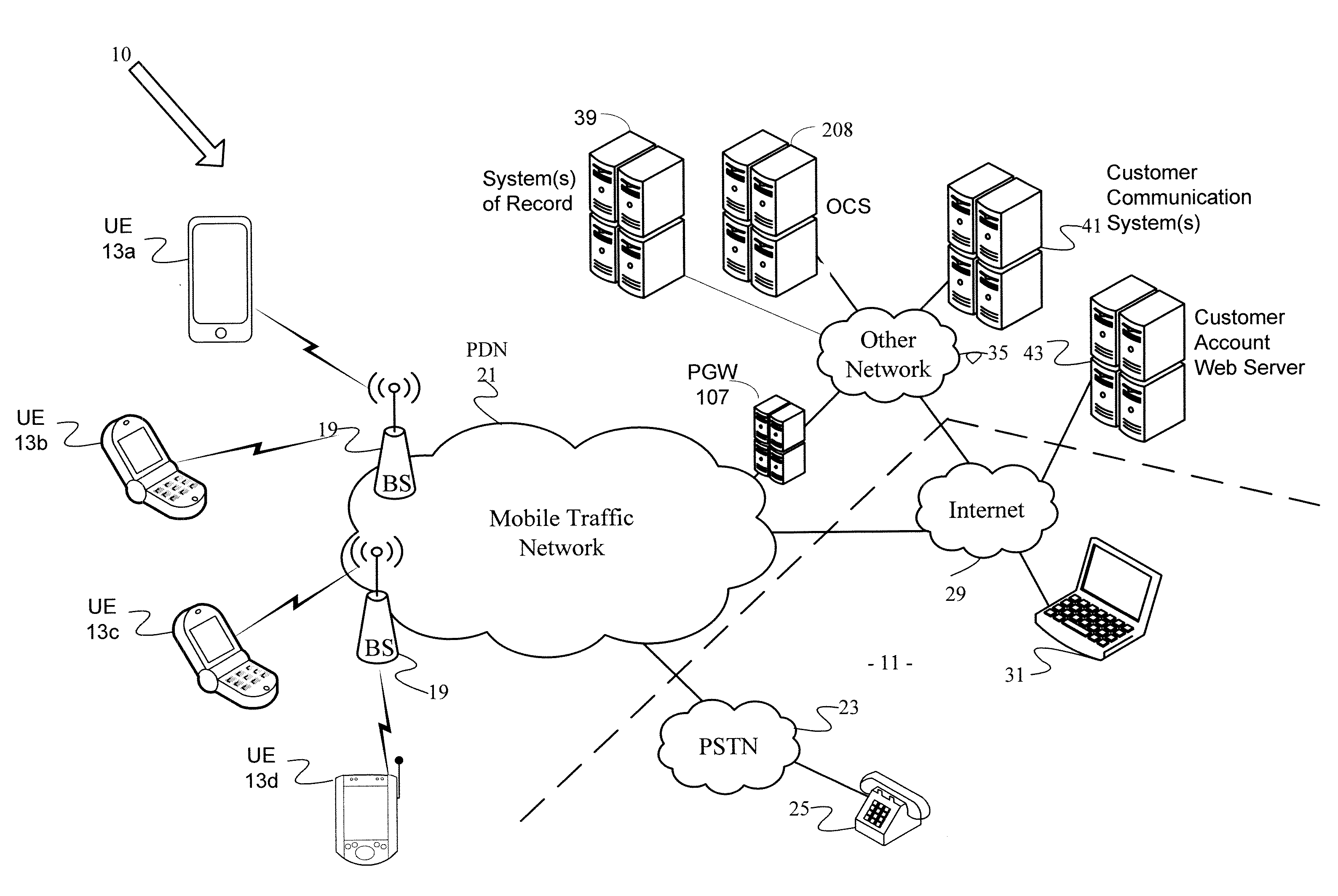

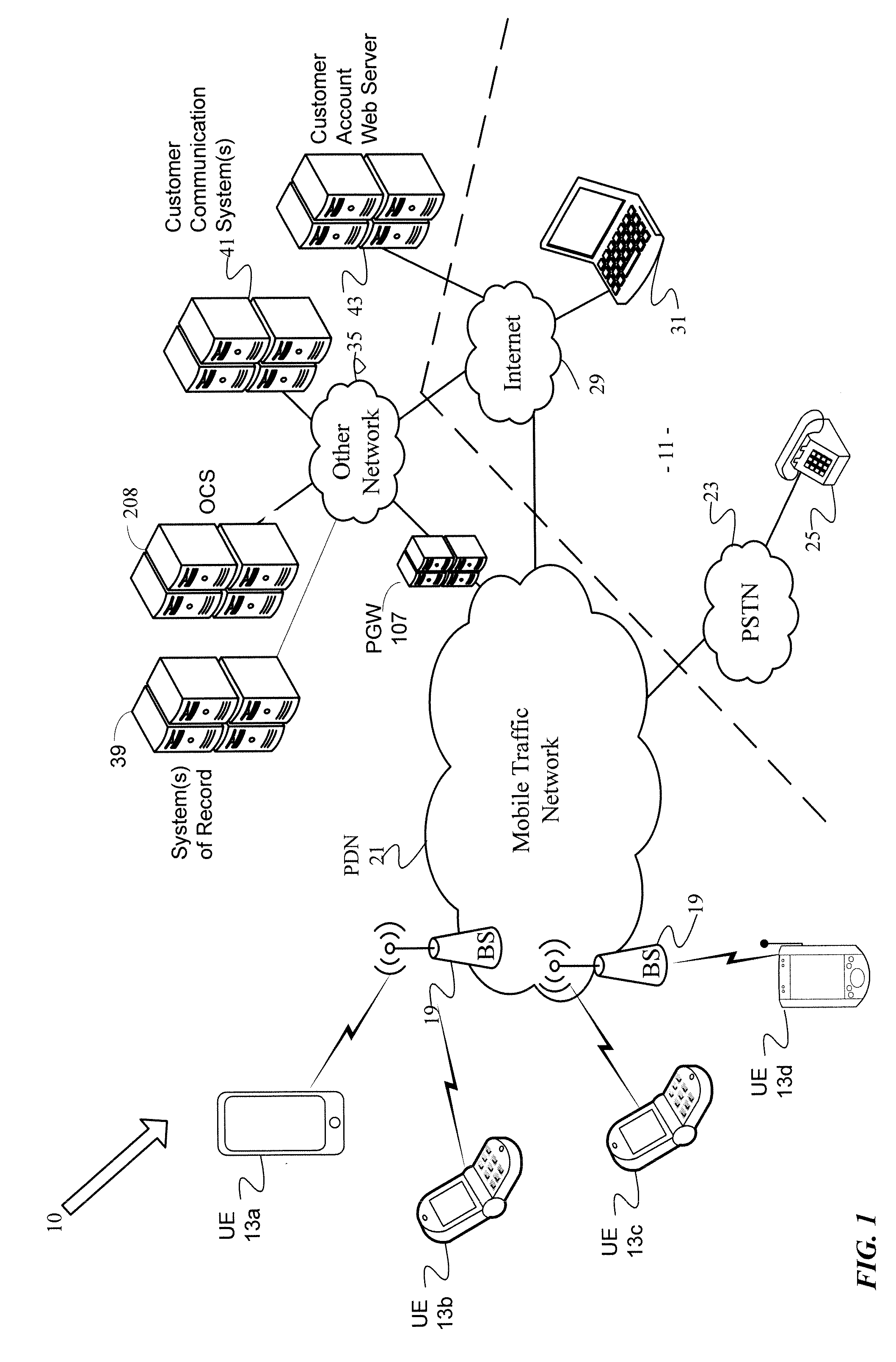

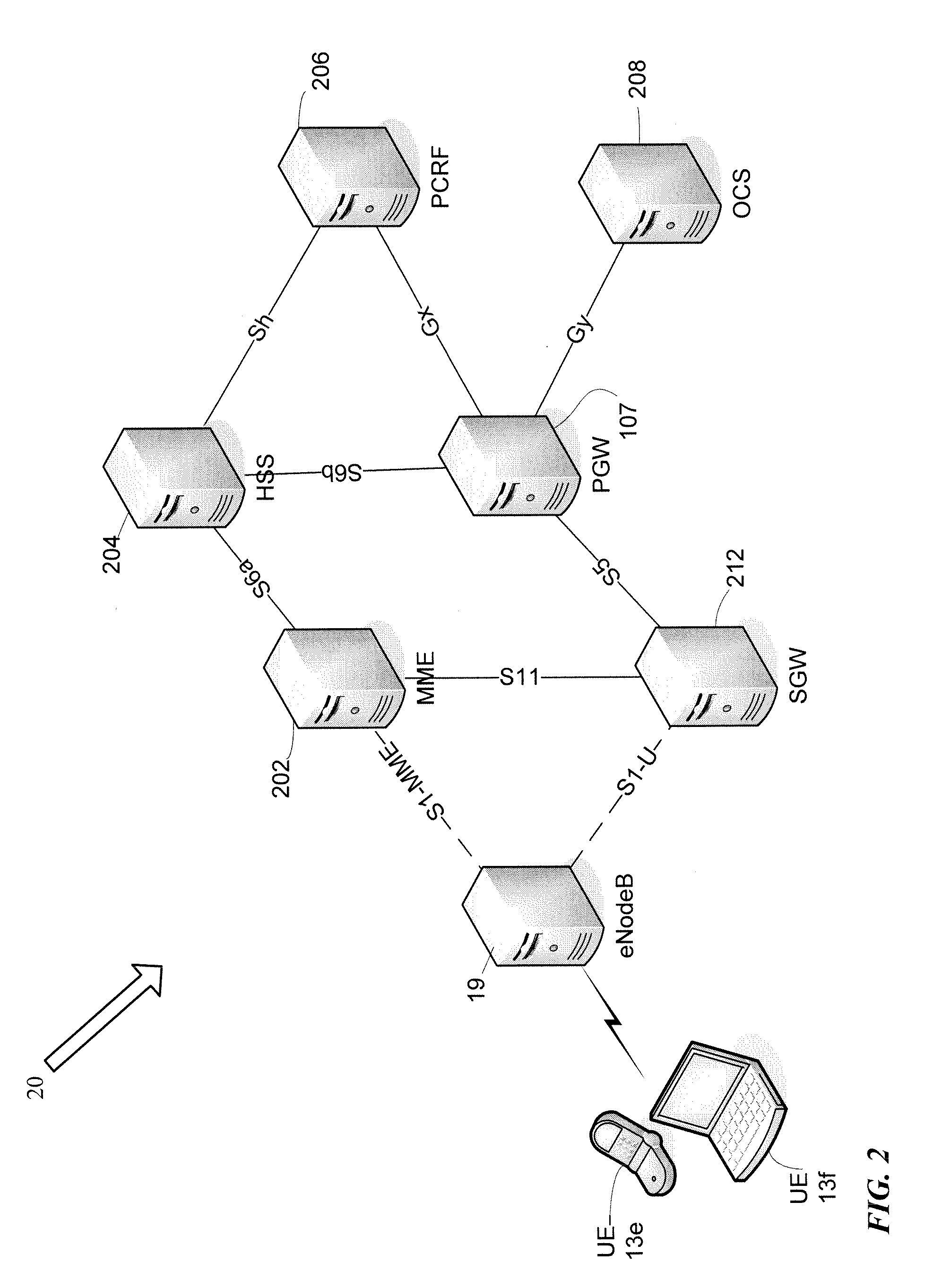

Method and system to provide network status information to a device

ActiveUS20130231080A1Accounting/billing servicesPrepayment with prepaid account/card rechargingTechnical standardMobile device

Network status information is provided to a mobile device. The data usage of the mobile device is tracked. A data usage criterion is determined from an account for the mobile device. The account information is stored on at least one server. The data usage is compared with the data usage criterion. Based on the comparison, it is determined whether the data usage meets the data usage criterion. Upon determining that the data usage meets the data usage criterion, a notification message is sent to the mobile device in real time through an information element field within an existing message in a bearer channel of the wireless packet data communication network. The notification message may instruct the mobile device to prevent generation and / or transmission of automatic network access requests while allowing user-initiated network access requests.

Owner:CELLCO PARTNERSHIP INC

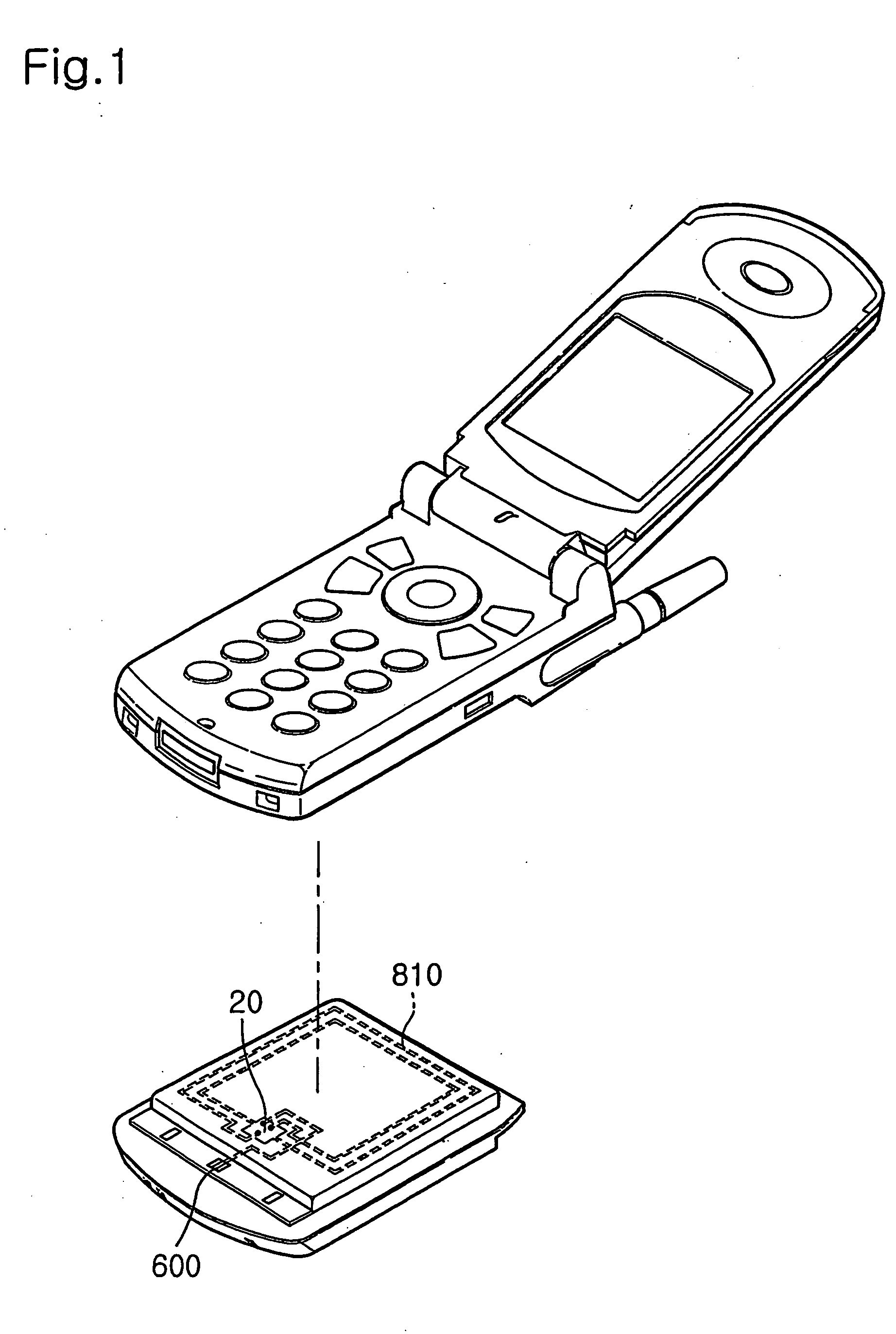

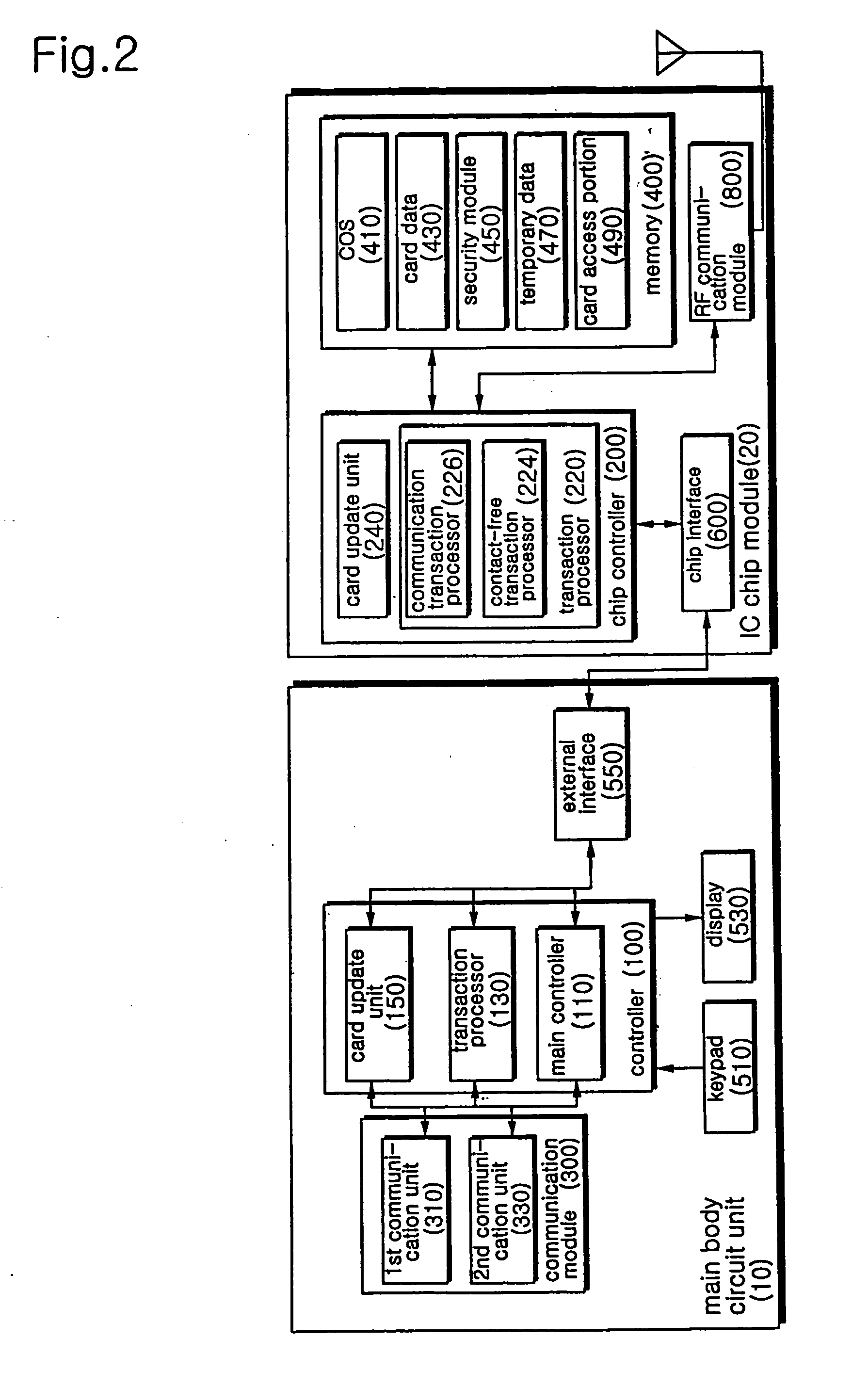

Mobile communication terminal having ic card settlement function

InactiveUS20070135164A1Improve security levelAccounting/billing servicesSubstation equipmentPaymentComputer terminal

The present invention relates to a method which supplies hard-ware to a mobile communication terminal. And it also discloses a payment method for a commercial transaction. A mobile communication terminal of the present invention includes a contactless IC chip module for handling payment in the machine itself The invention process reading / writing directly by interfacing its chip module with a serial interface to a micro-processor of the terminal. Therefore, it is possible to renew card information, and to issue / cancel a card, and to save multiple cards. By selecting a function, a mobile communication terminal uses it as on-line payment or contactless off-line payment.

Owner:SEYFARTH SHAW

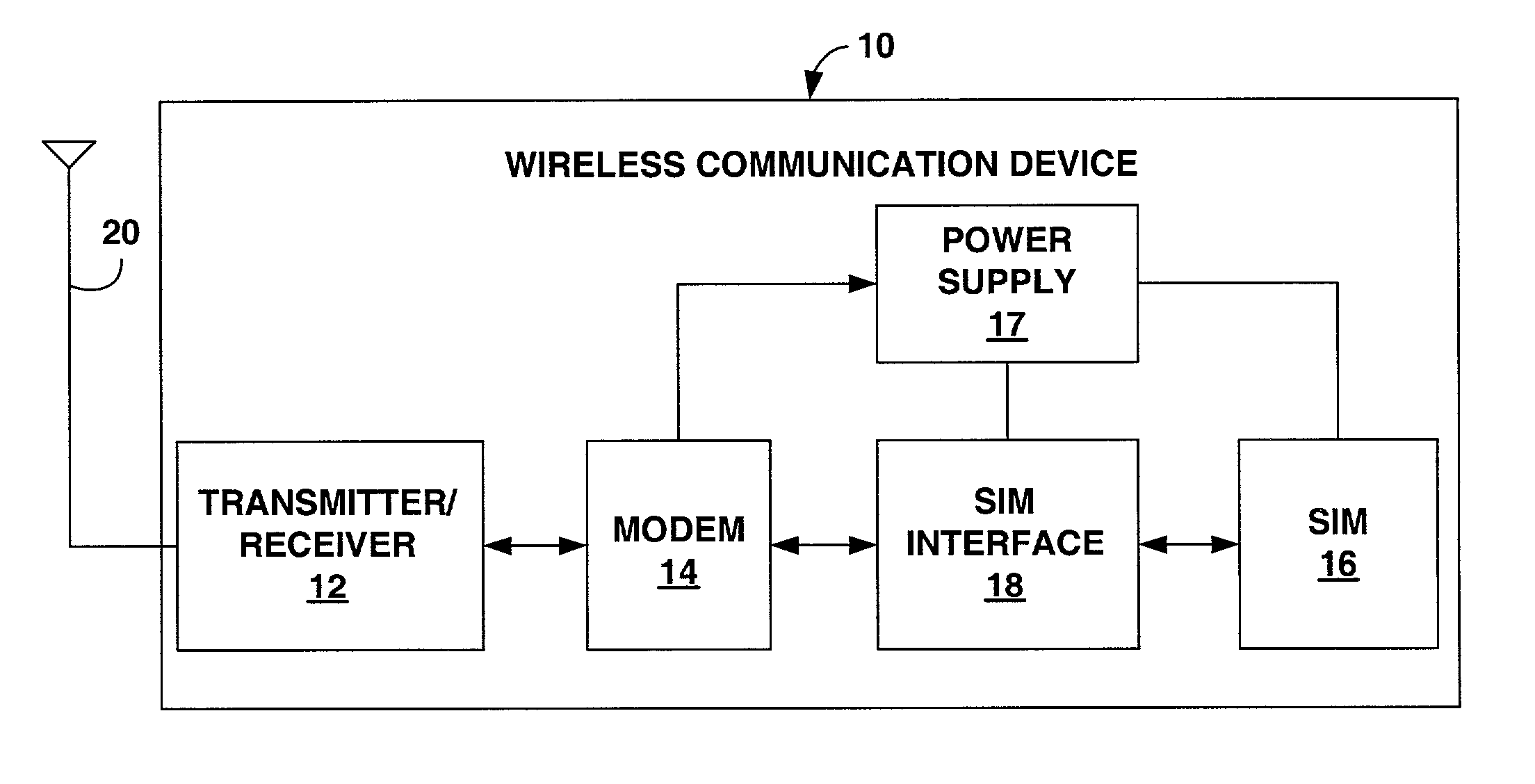

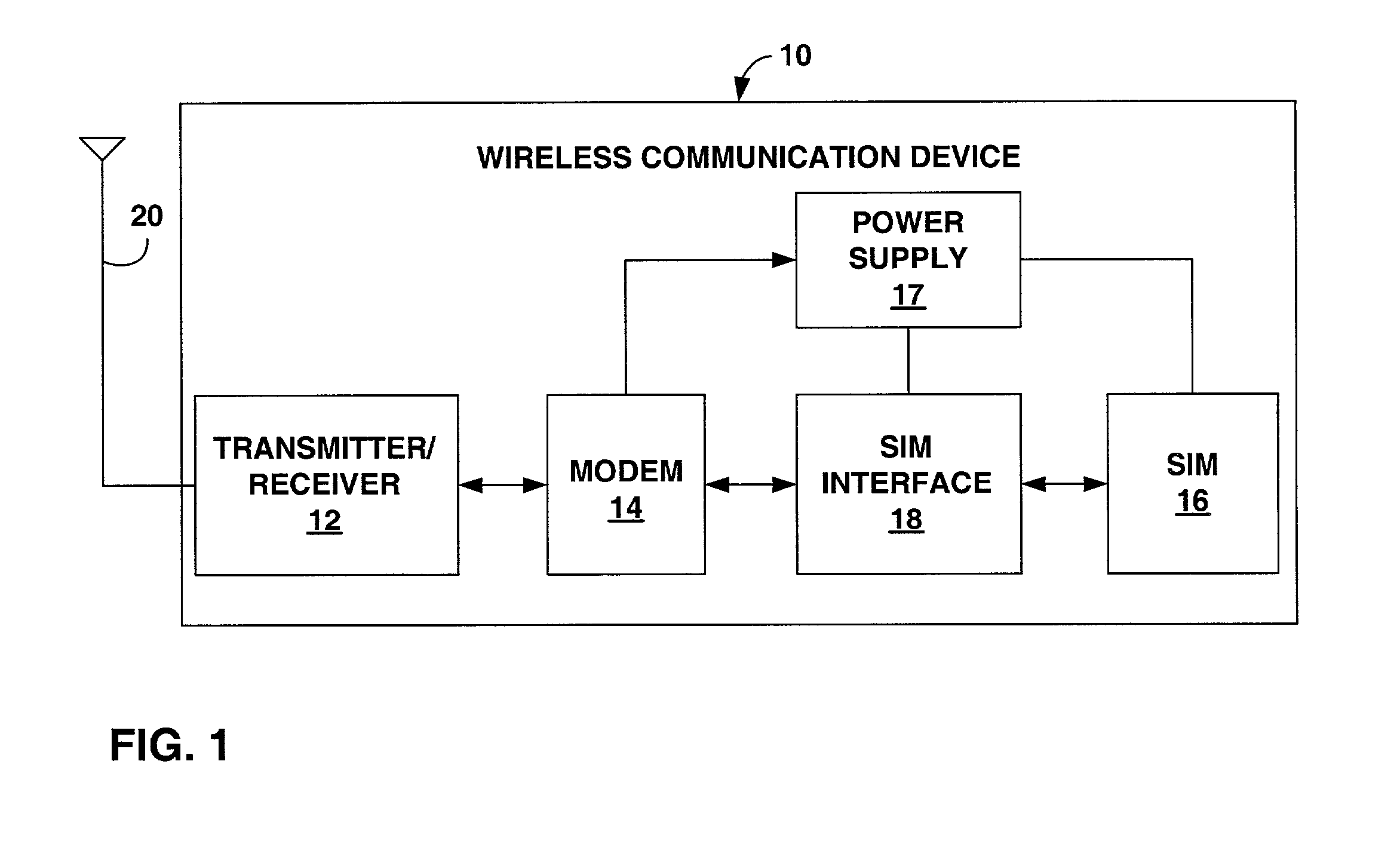

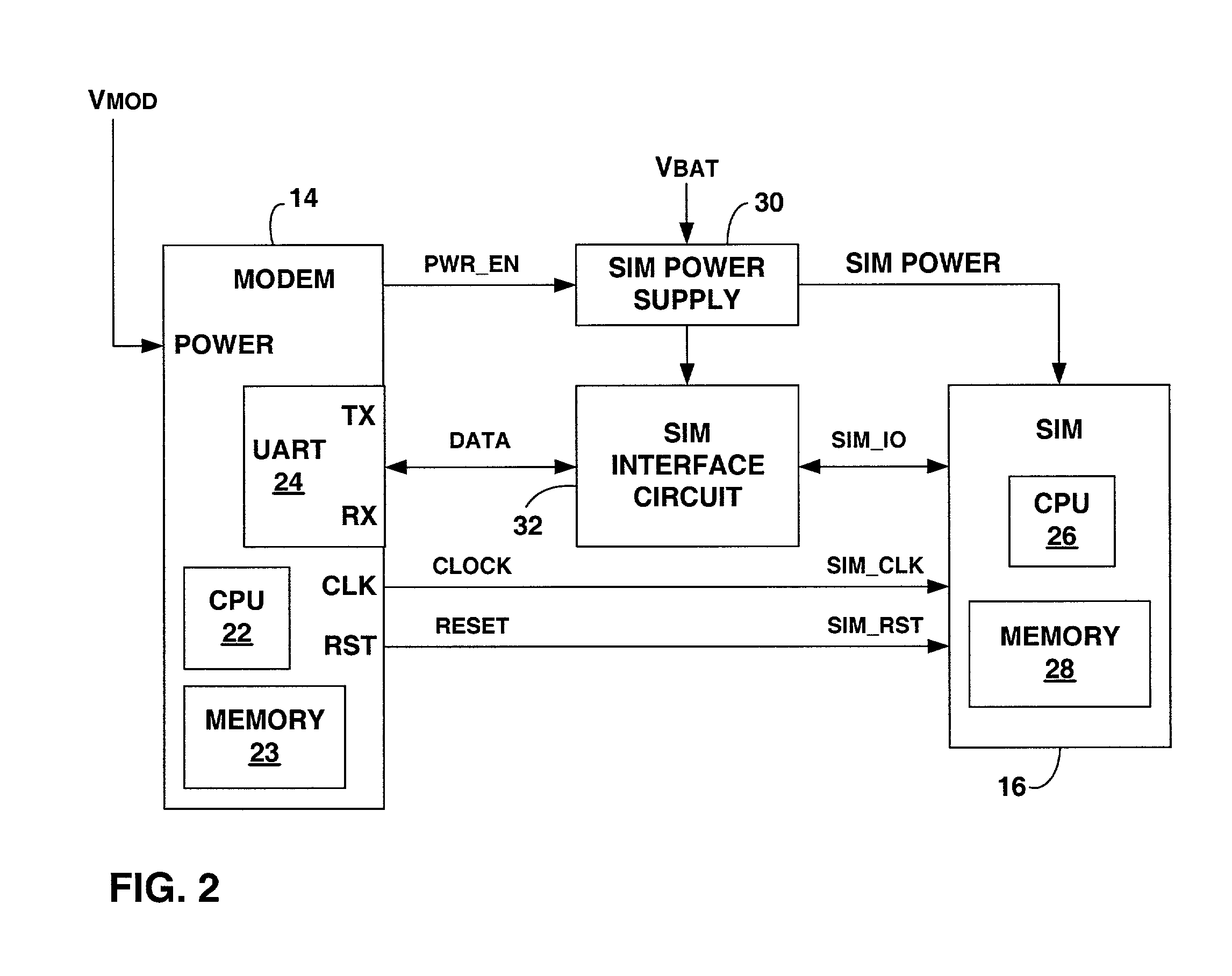

Subscriber identity module verification during power management

InactiveUS7137003B2Unauthorised/fraudulent call preventionEavesdropping prevention circuitsUnique identifierComputer module

Power management techniques for a Subscriber Identity Module (SIM) of a wireless communication device (WCD) are described tat make use of a unique identifier for the SIM. In particu1ar a processor within the WCD reads a first unique identifier from the SIM when power is initially supplied to the WCD, and stores the first unique identifier within a computer-readable medium within the WCD. During a power management cycle, where power is terminated and then re-supplied to the SIM, the processor again receives a unique identifier from the SIM and compares the second unique identifier with the stored unique identifier. These tecbniques are useful in detecting whether the attached SIM has been exchanged for a different SIM while powered down during a power management cycle.

Owner:QUALCOMM INC

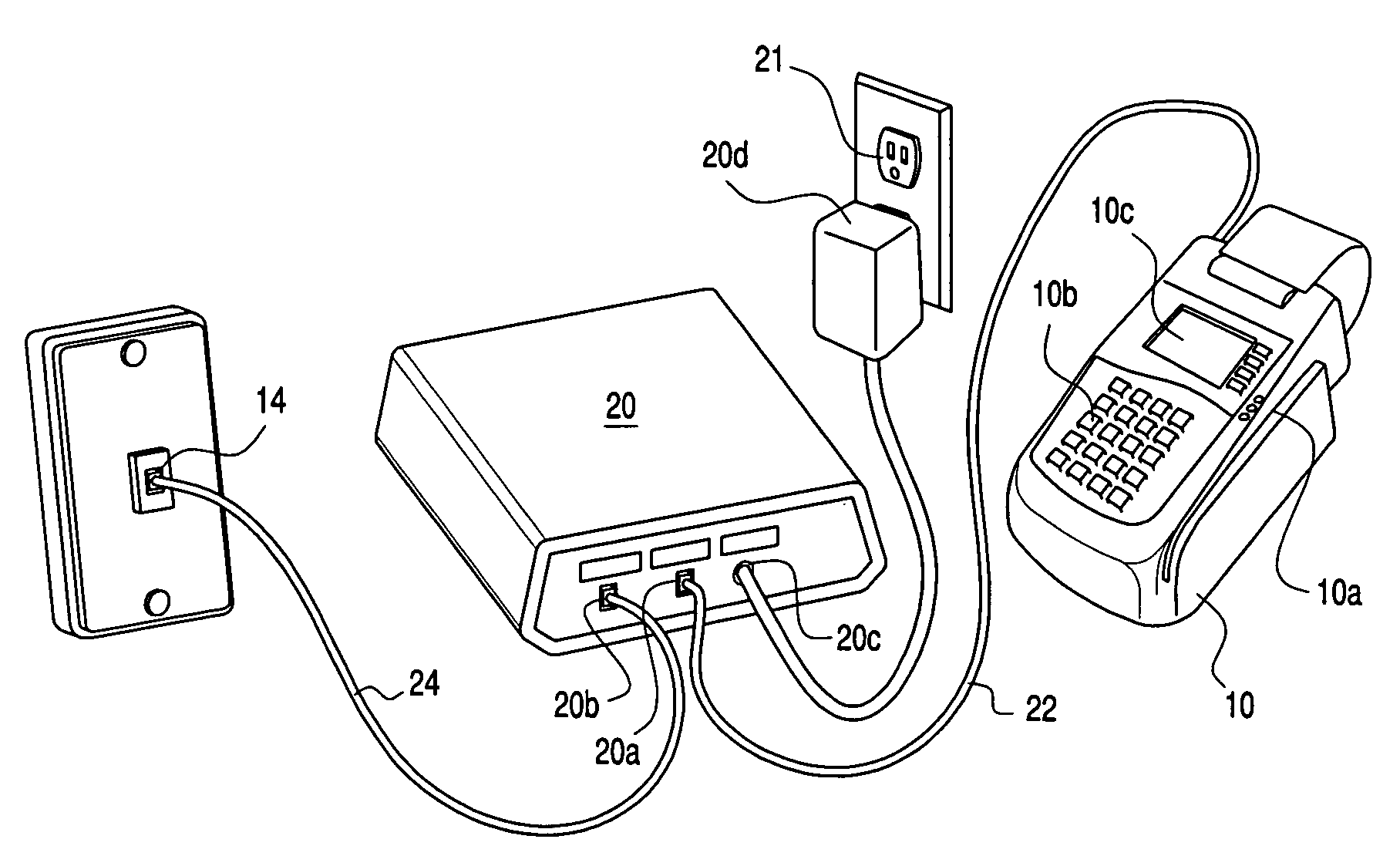

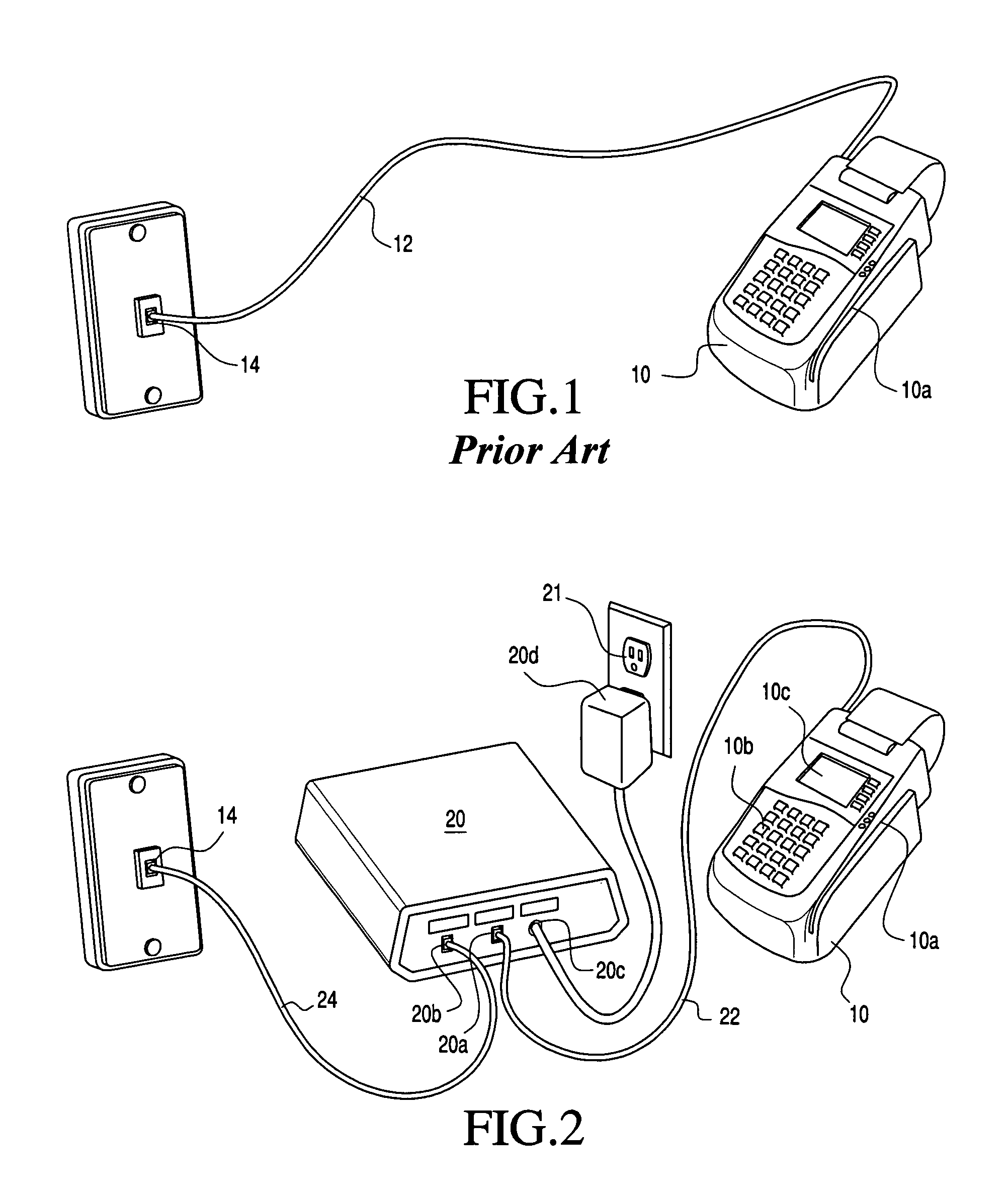

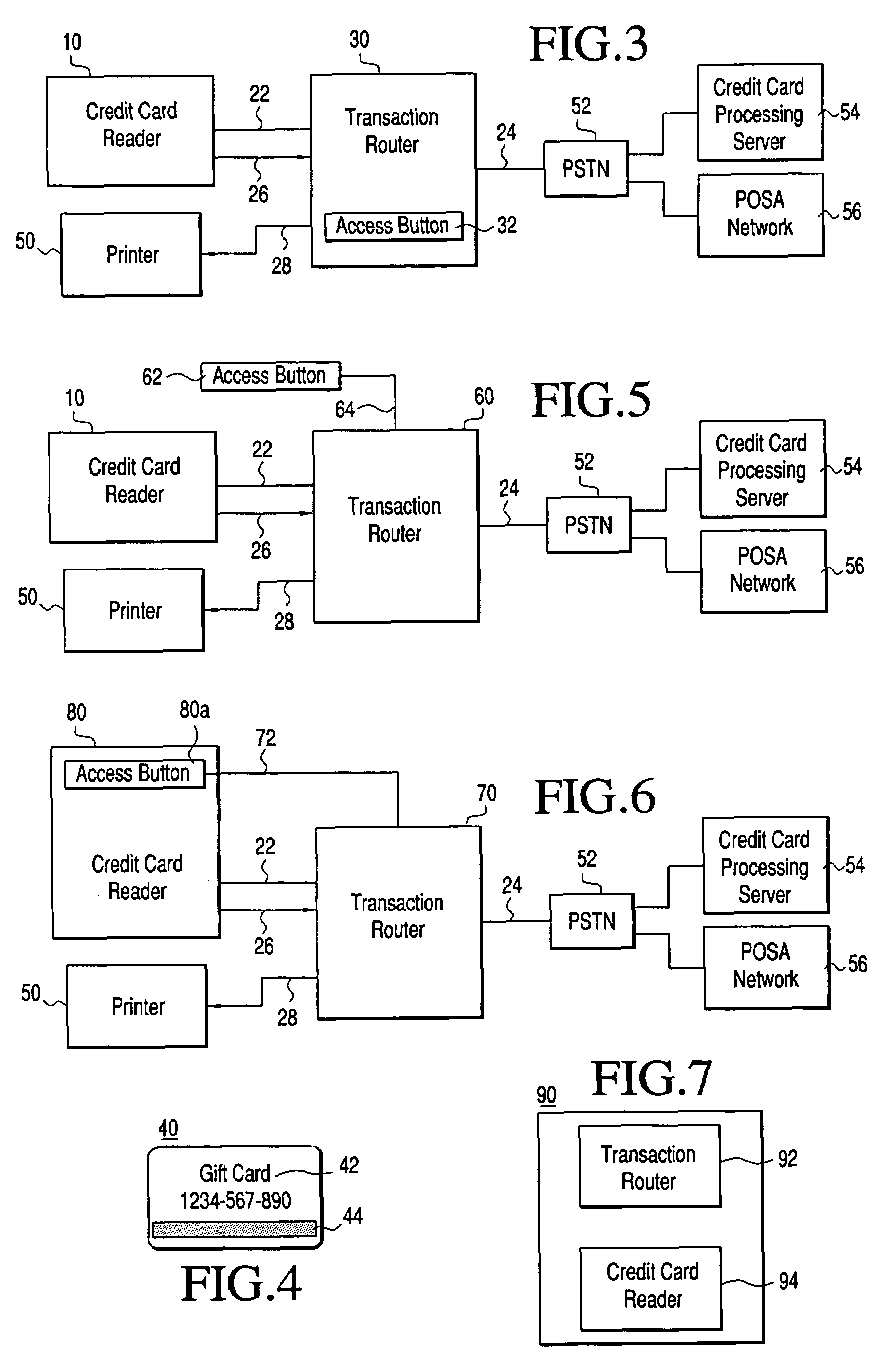

Intelligent transaction router and process for handling multi-product point of sale transactions

ActiveUS7580859B2Efficient activation and saleIncrease valueComplete banking machinesUser identity/authority verificationComputer terminalTelephone card

A transaction router and corresponding process that enables the point-of-sale activation (POSA) of POSA type devices, such as POSA pre-paid gift cards, debit cards, telephone cards and cellular replenishment cards, while utilizing a standard credit card swipe terminal (reader). The transaction router, during use, receives the output of the reader and allows standard credit and debit card transactions to pass to the financial transaction processing entity that is called by the reader, to allow the financial transaction to be carried out. If the card or device being read by the reader is a POSA type device to be activated, then the router routes the communication initiated by the reader to another processing entity capable of activating the POSA device. The reader is unaware of the existence of the router and operates in its ordinary manner, whether standard credit and debit cards are being processed, or whether a POSA card or other POSA device is being activated. Increasing the value of a previously activated POSA card also may be carried out.

Owner:E2INTERACTIVE INC D B A E2INTERACTIVE

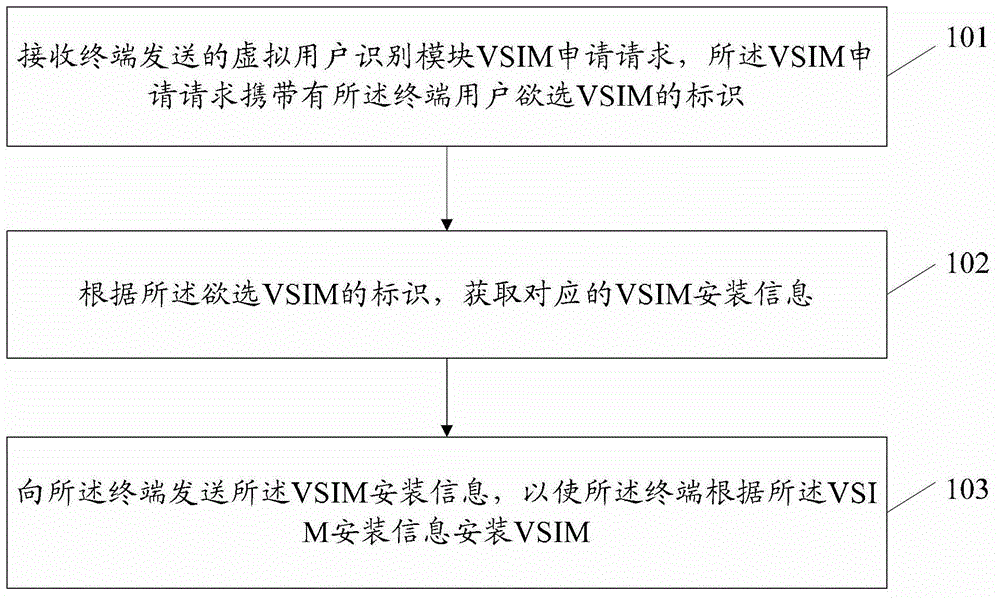

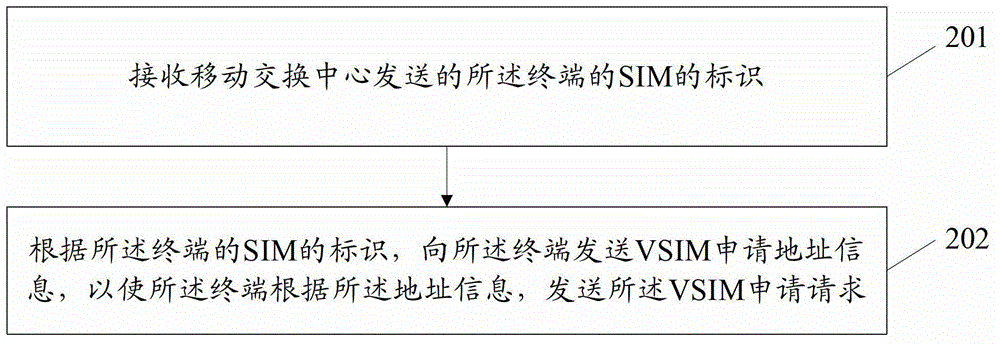

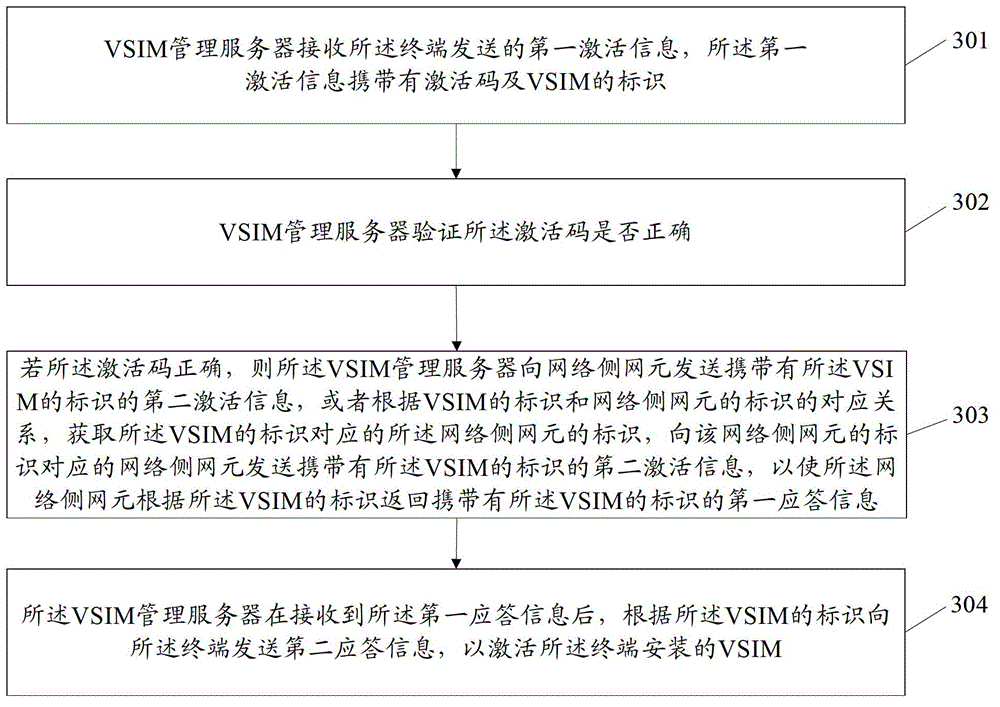

Methods, device and system for realization and communication of virtual subscriber identity module

ActiveCN102917339AIncrease the way of providingReduce manufacturing costCoin/check-freed systemsNetwork data managementSubscriber identity moduleComputer science

The invention provides methods, a device and a system for realization and communication of a virtual subscriber identity module (VSIM). The method for the realization of the virtual subscriber identity module comprises the following steps: receiving a VSIM application request transmitted by a terminal, wherein the VSIM application request carries a VSIM identity which is to be selected by the terminal; obtaining corresponding VSIM installation information based on the identity of the VSIM to be selected; and sending the VSIM installation information to the terminal so as to enable the terminal to install the VSIM according to the VSIM installation information. The embodiment of the invention can effectively solve the problem that the existing mobile operator networks do not support the VSIM, and by using the embodiment of the invention, an effective and convenient operation program for existing domestic or international roaming service can be provided.

Owner:HUAWEI TECH CO LTD

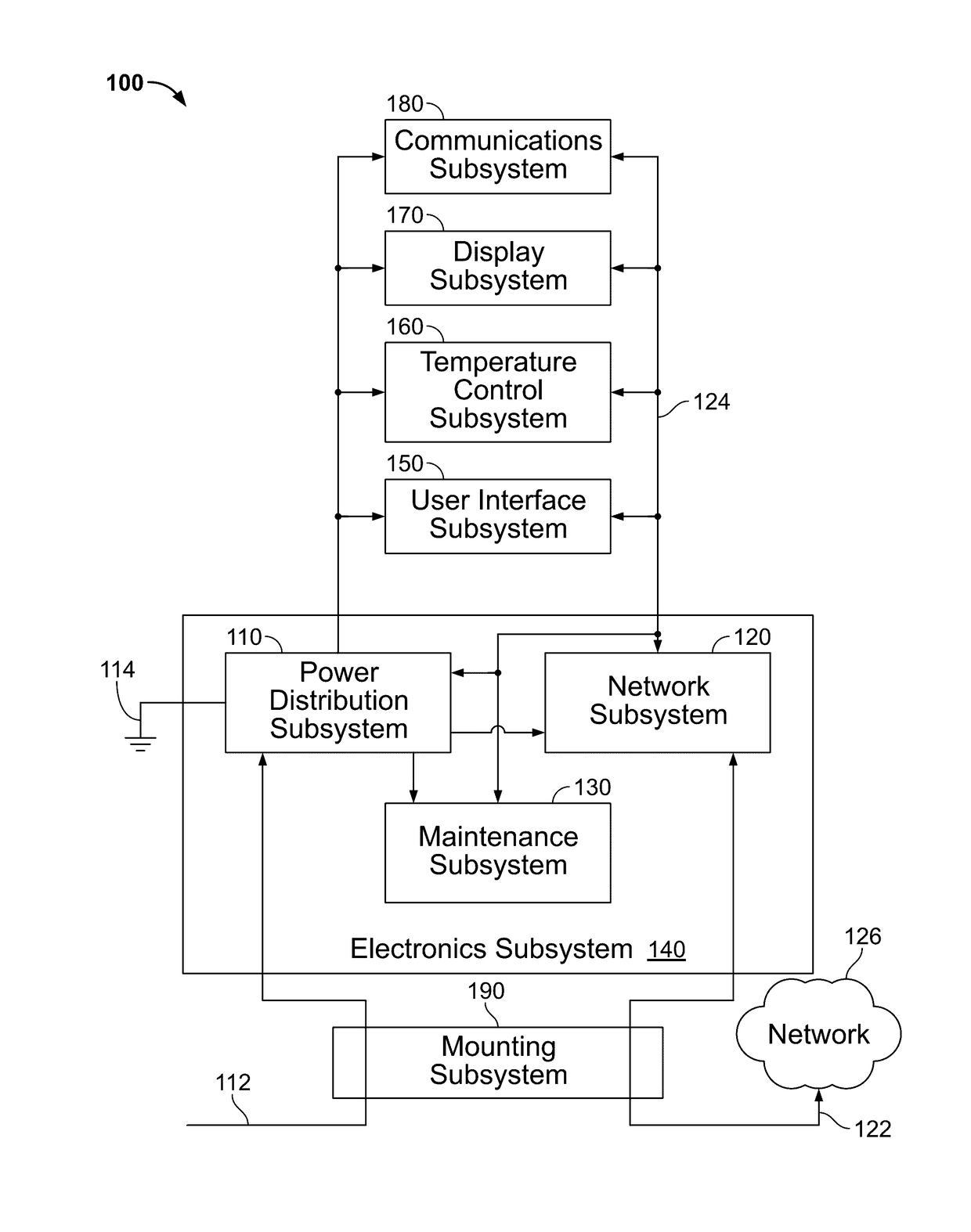

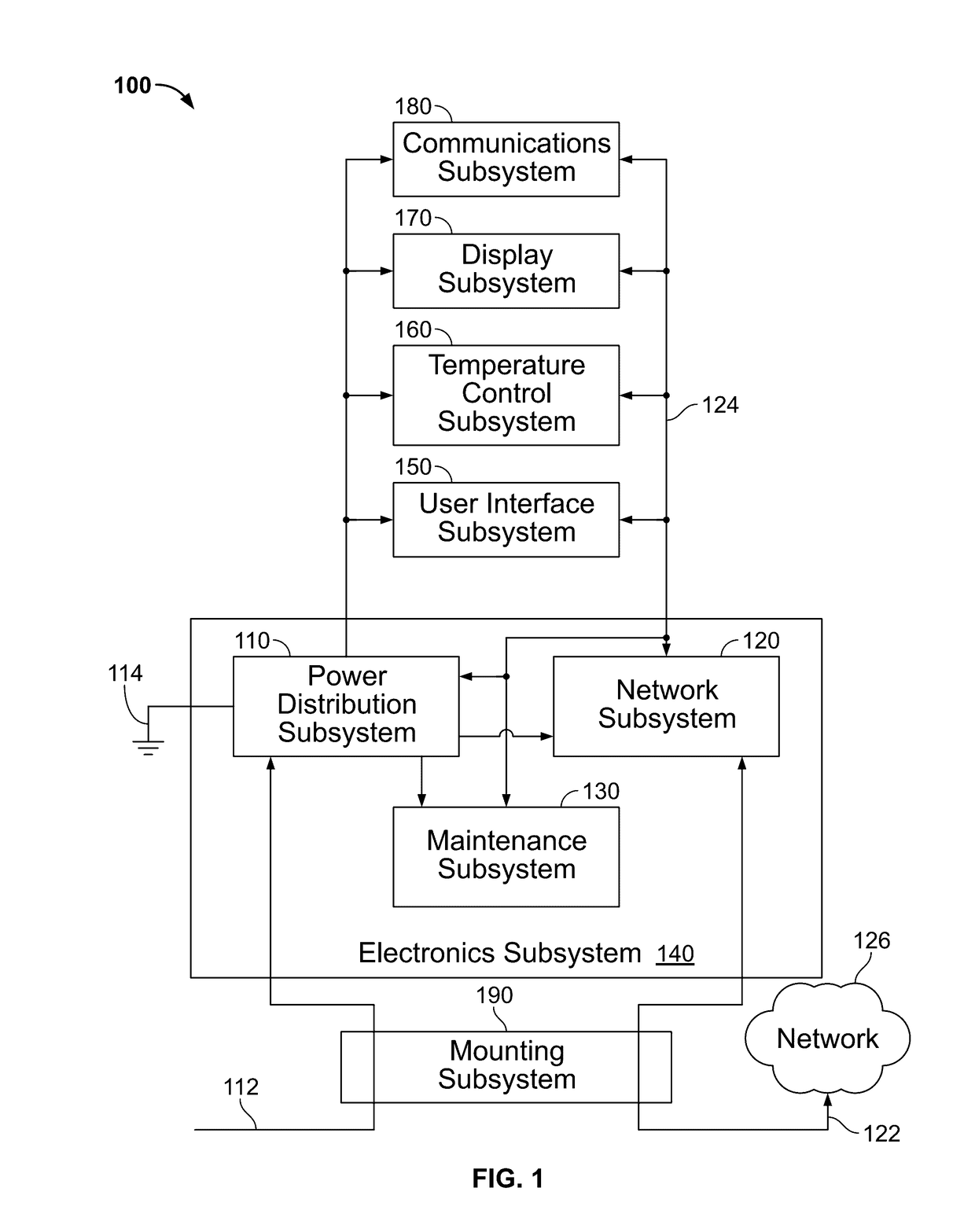

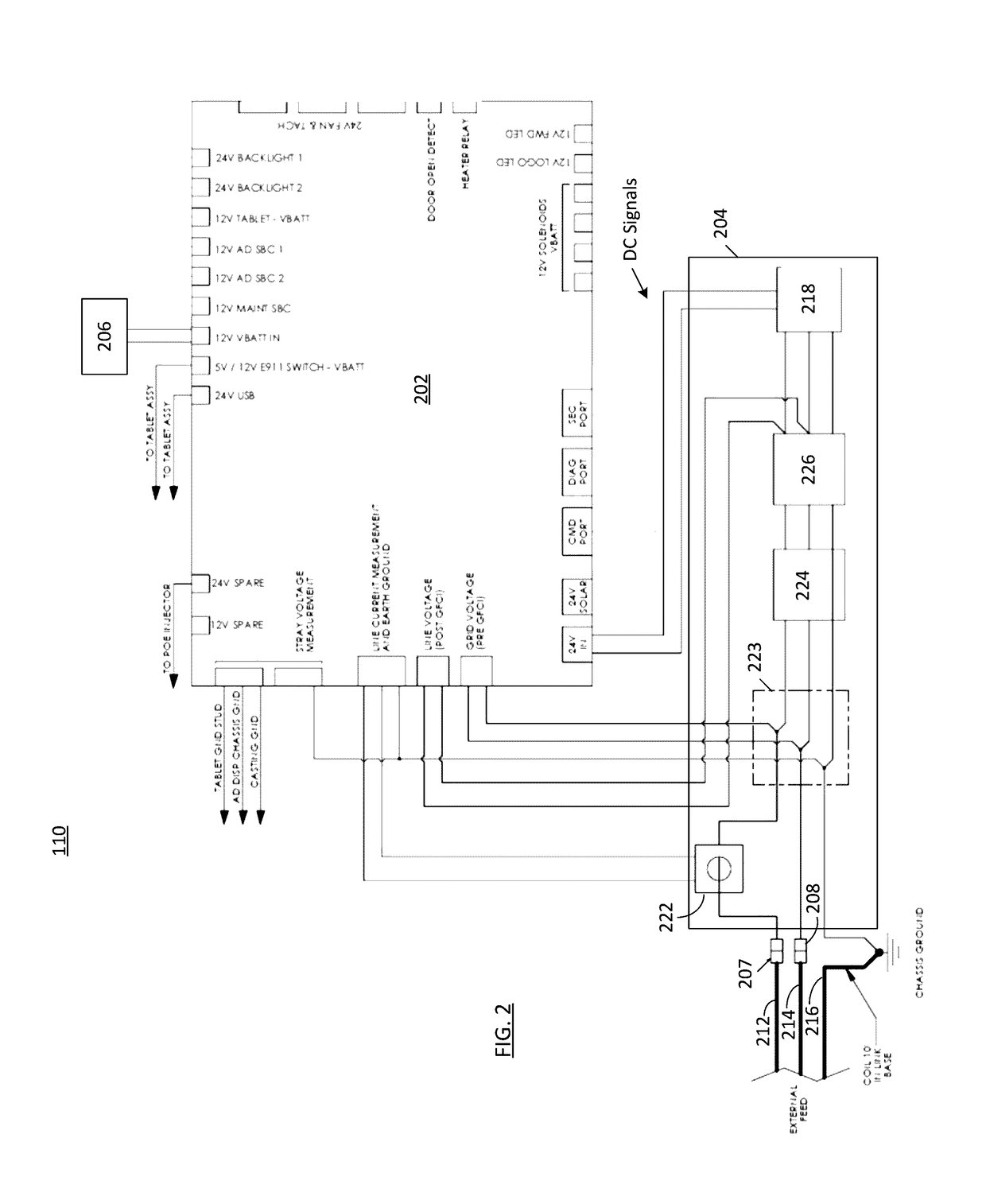

Method and apparatus for power and temperature control of compartments within a personal communication structure (PCS)

ActiveUS20170111520A1Easy accessExpand accessVolume/mass flow measurementPower supply for data processingTemperature controlElectronic systems

Techniques and apparatus for controlling the distribution of power (e.g., current) and the temperature to individually accessible compartments enclosing subsystems of a personal communication structure (PCS) is described. The PCS includes a power distribution and temperature controller subsystem, including thermal sensors adapted to generate and transmit temperature measurement data to the temperature controller, which controls fans / blowers. The power distribution subsystem senses and controls the current delivered to the individually accessible compartments.

Owner:CITYBRIDGE LLC

Method and system for remote delivery of retail banking services

A practical system and method for the remote distribution of financial services (e.g., home banking and bill-paying) involves distributing portable terminals to a user base. The terminals include a multi-line display, keys “pointing to” lines on the display, and additional keys. Contact is established between the terminals and a central computer operated by a service provider, preferably over a dial-up telephone line and a packet data network. Information exchange between the central computer and the terminal solicits information from the terminal user related to requested financial services (e.g., for billpaying, the user provides payee selection and amount and his bank account PIN number). The central computer then transmits a message over a conventional ATM network debiting the user's bank account in real time, and may pay the specified payees the specified amount electronically or in other ways as appropriate. Payments and transfers may be scheduled in advance or on a periodic basis. Because the central computer interacts with the user's bank as a standard POS or ATM network node, no significant software changes are required at the banks' computers. The terminal interface is extremely user-friendly and incorporates some features of standard ATM user interfaces so as to reduce new user anxiety.

Owner:OFFICIAL PAYMENTS

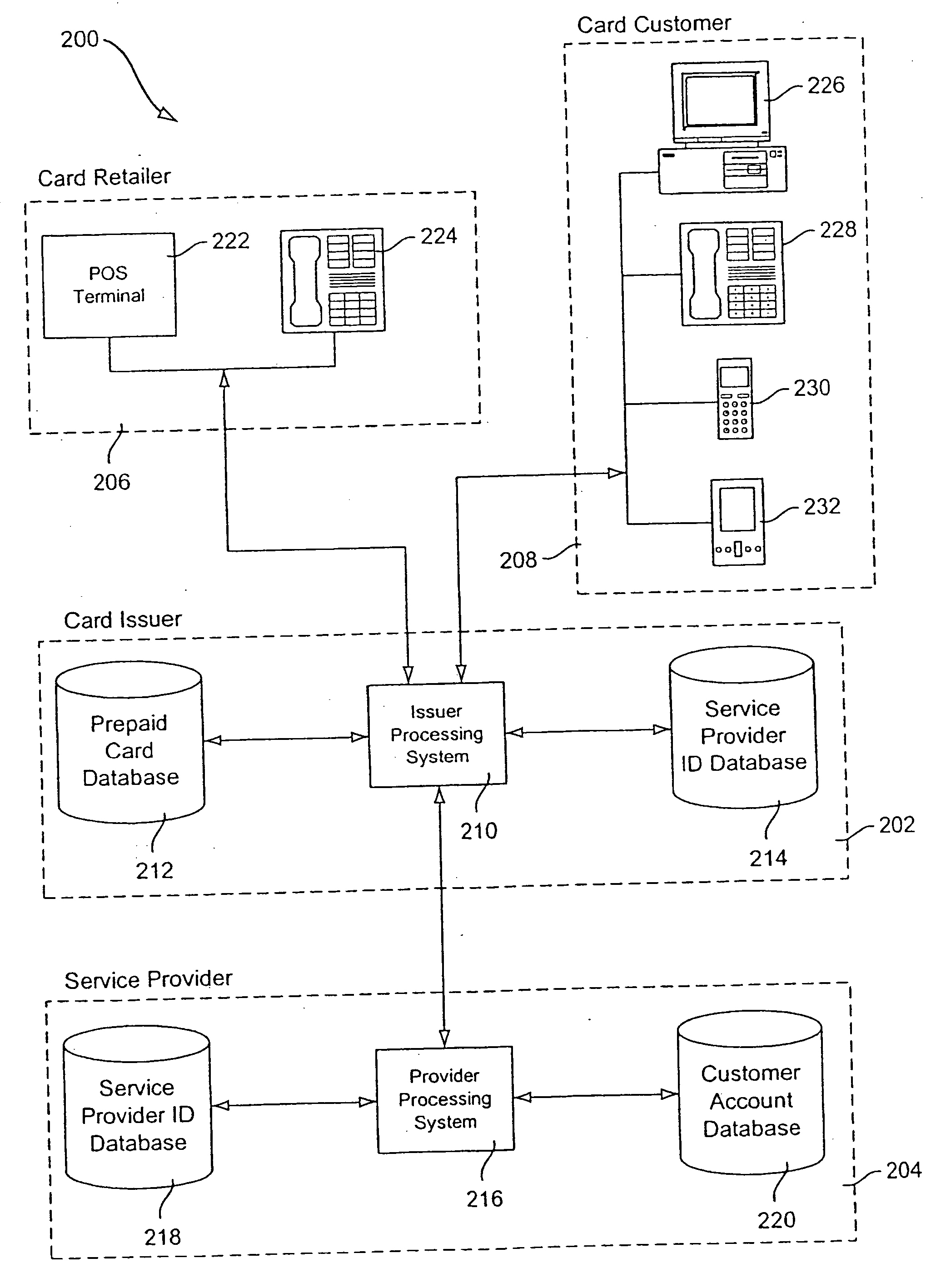

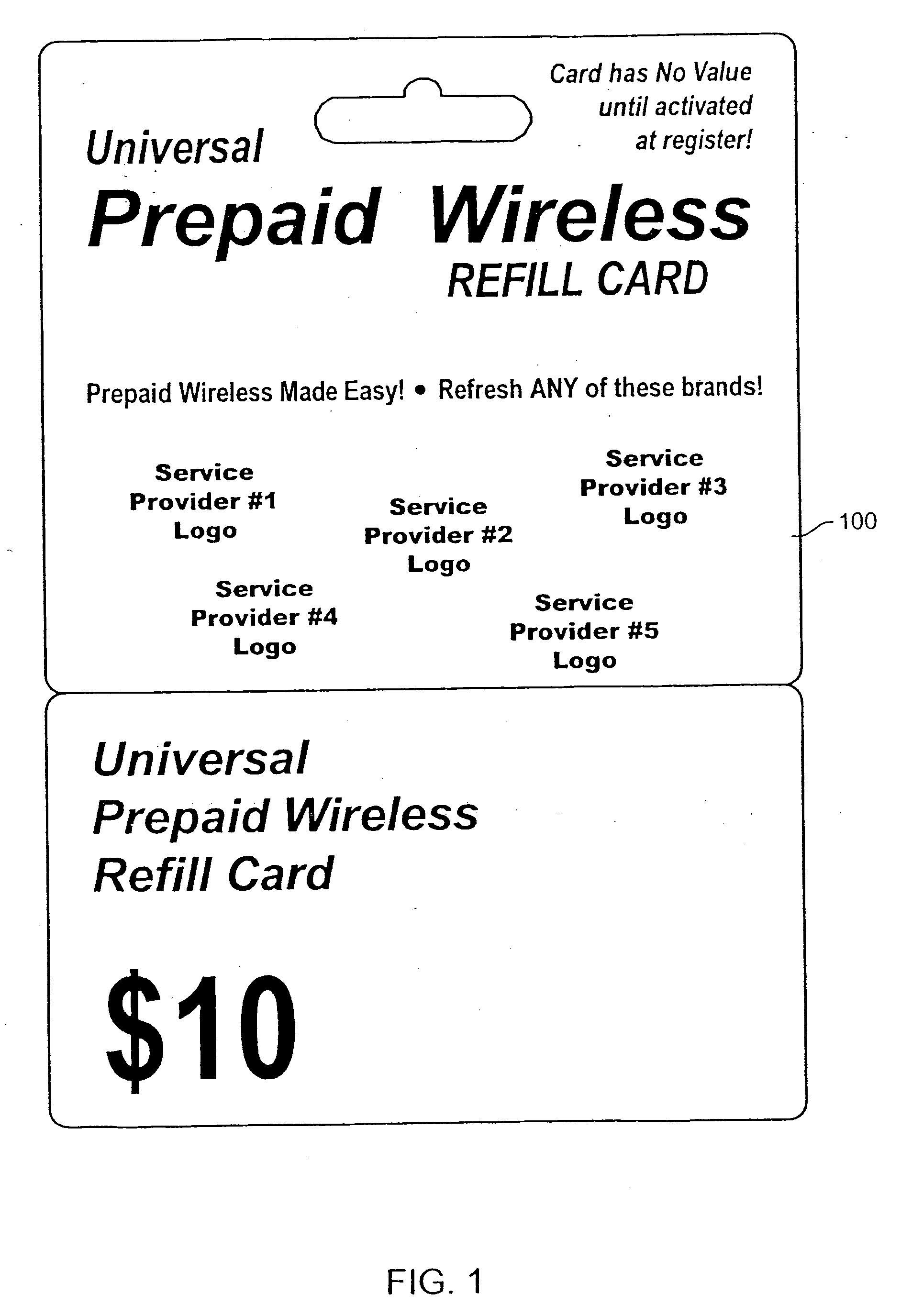

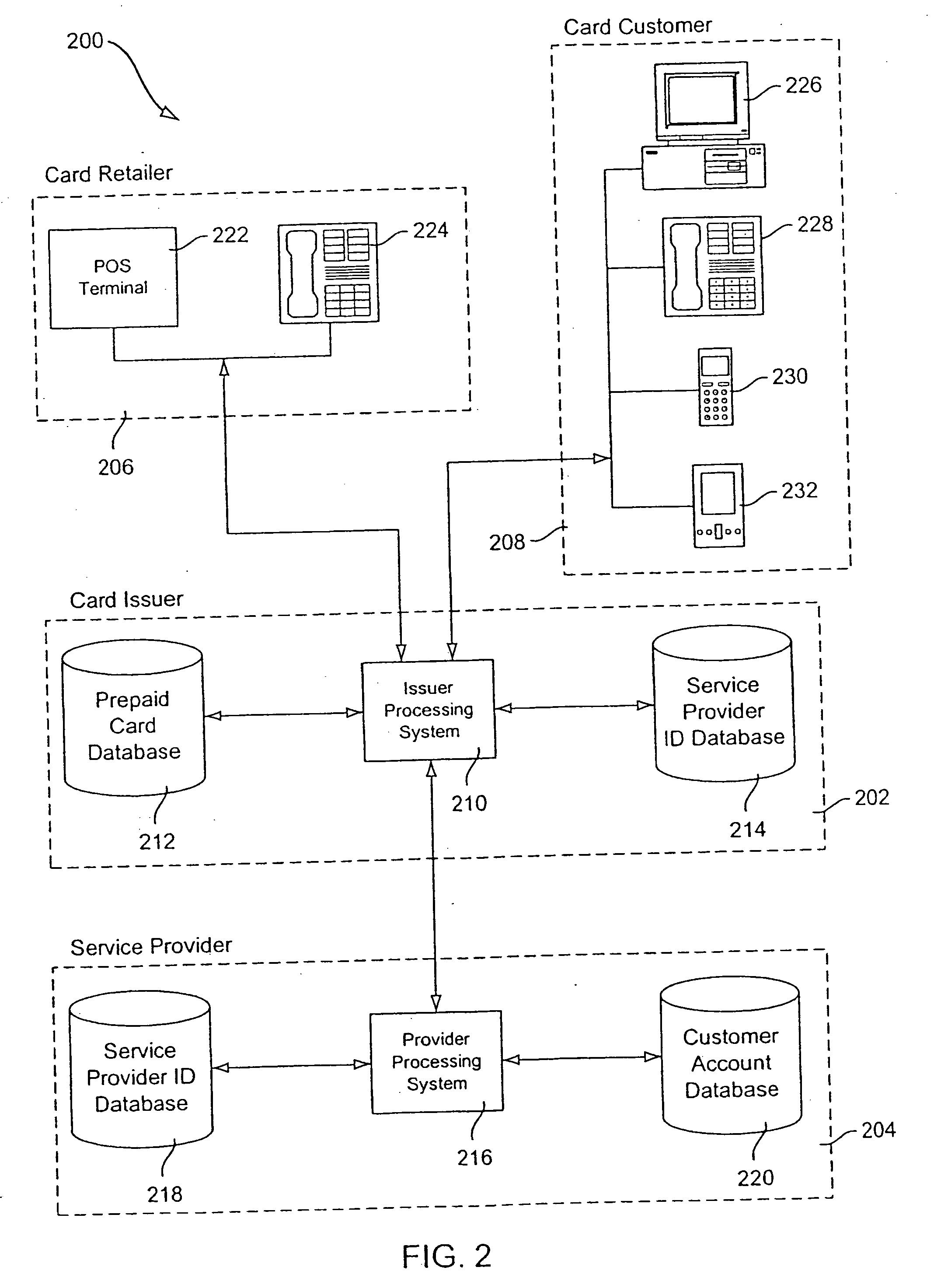

Universal prepaid telecommunication services card, and methods and systems for using same

InactiveUS20060023856A1Pre-payment schemesPrepayment telephone using commercial credit/debitComputer hardwareService provision

In a relationship in which a universal prepaid telecommunication services card issuer is different than a telecommunication services provider, a method and system for implementing a universal prepaid telecommunication services card (prepaid card), which can be used as a prepaid card for a plurality of services providers providing one or more telecommunication services. The method comprises a card issuer providing a prepaid card having a identification number associated with the prepaid card. Upon receiving a prepaid card activation request from a card seller or distributor, the card issuer activates the prepaid card. After the card is activated, the card issuer can receive a request to use the card from a user. The card issuer then receives from the user the identification number associated with the prepaid card and validates the identification number. Upon validation of the identification number, the card issuer receives from the user a service request for a particular service provider. The card issuer then communicates the service request to the particular service provider.

Owner:QWEST

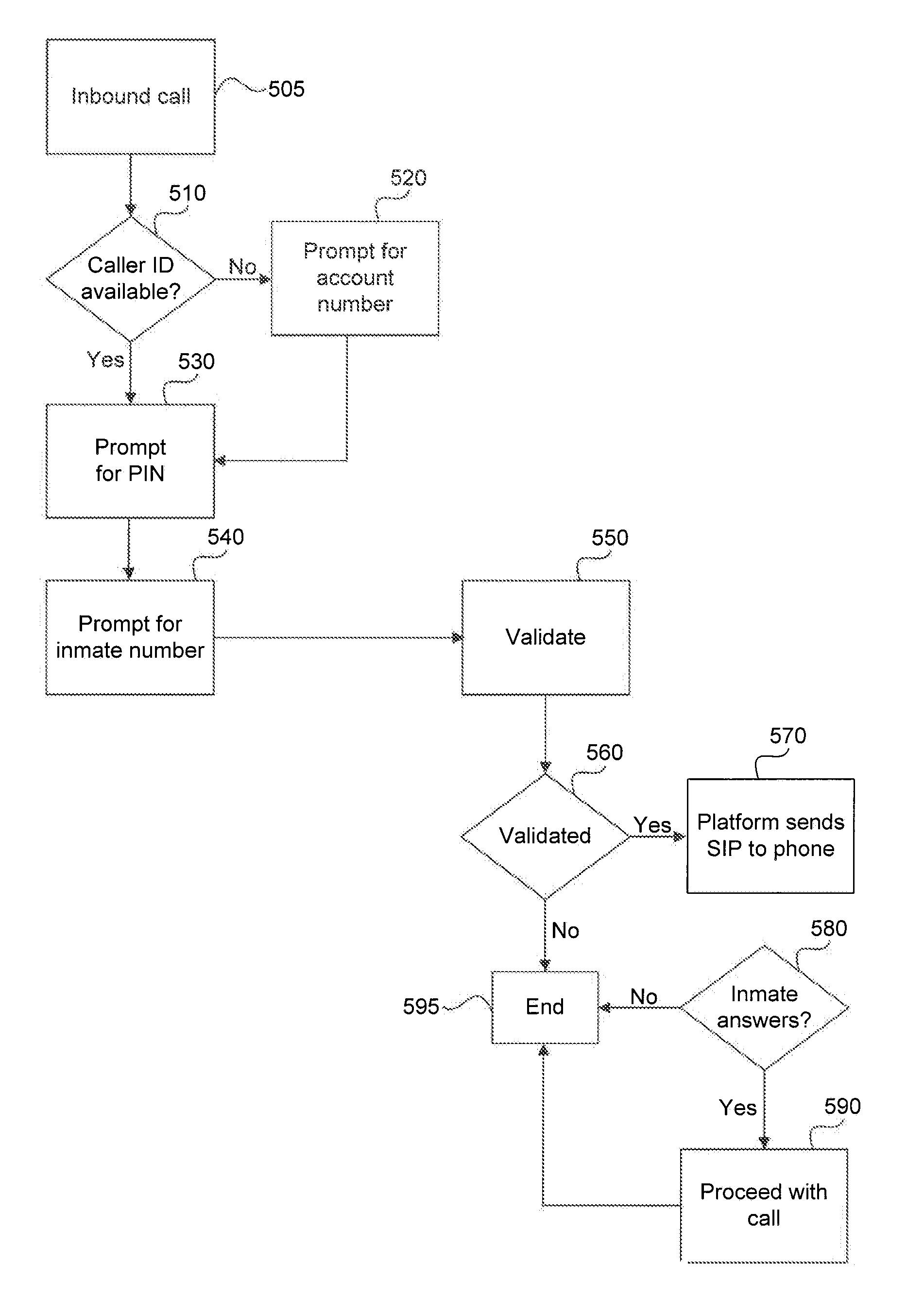

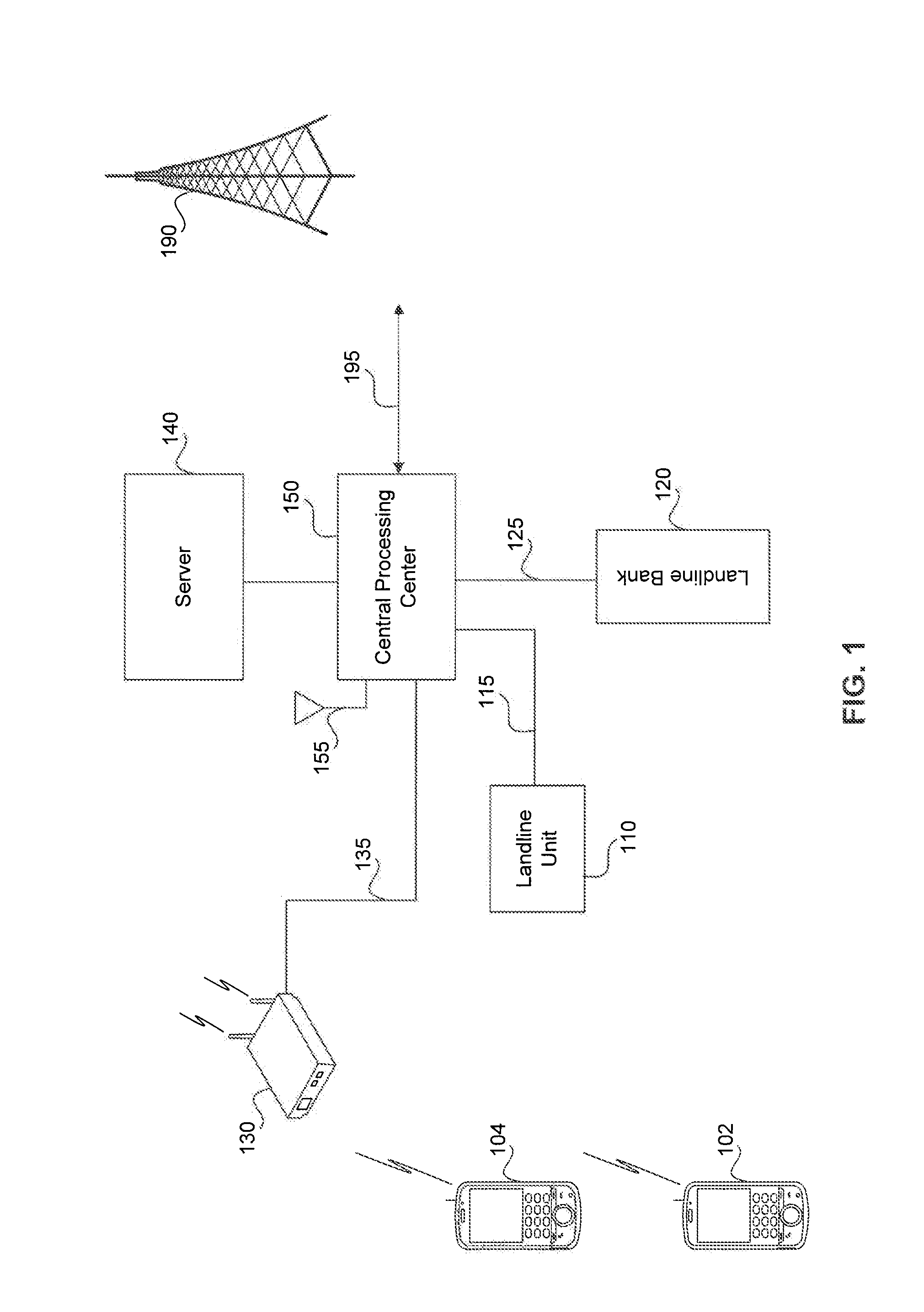

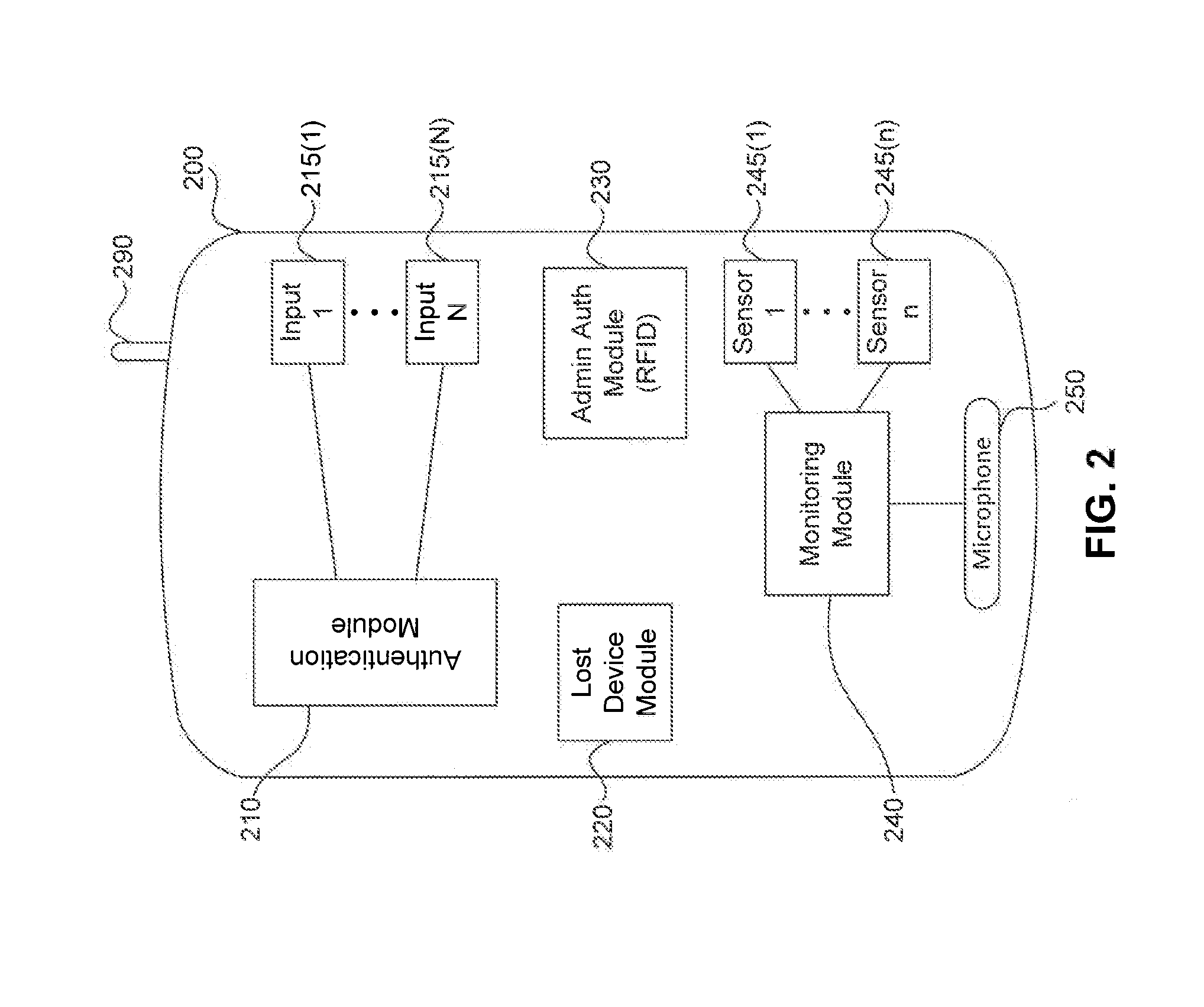

Multifunction Wireless Device

ActiveUS20140287715A1Accounting/billing servicesNetwork topologiesInternet protocol suiteCommunication device

A communication device and system are disclosed for providing communication and data services to residents of a controlled facility. The device can be restricted to communicating only using an internet protocol so as to restrict the device communication to an internal intranet. Wireless access points may be disposed throughout the environment to route calls and data between the device and a central processing center. By converting a protocol of the communications received from the device to a protocol used by the central processing center, minimal modifications to the central processing center are needed to support a wireless communication infrastructure. Many restrictions and safeguards may be implemented within the phone and system in order to prevent improper use.

Owner:GLOBAL TELLINK

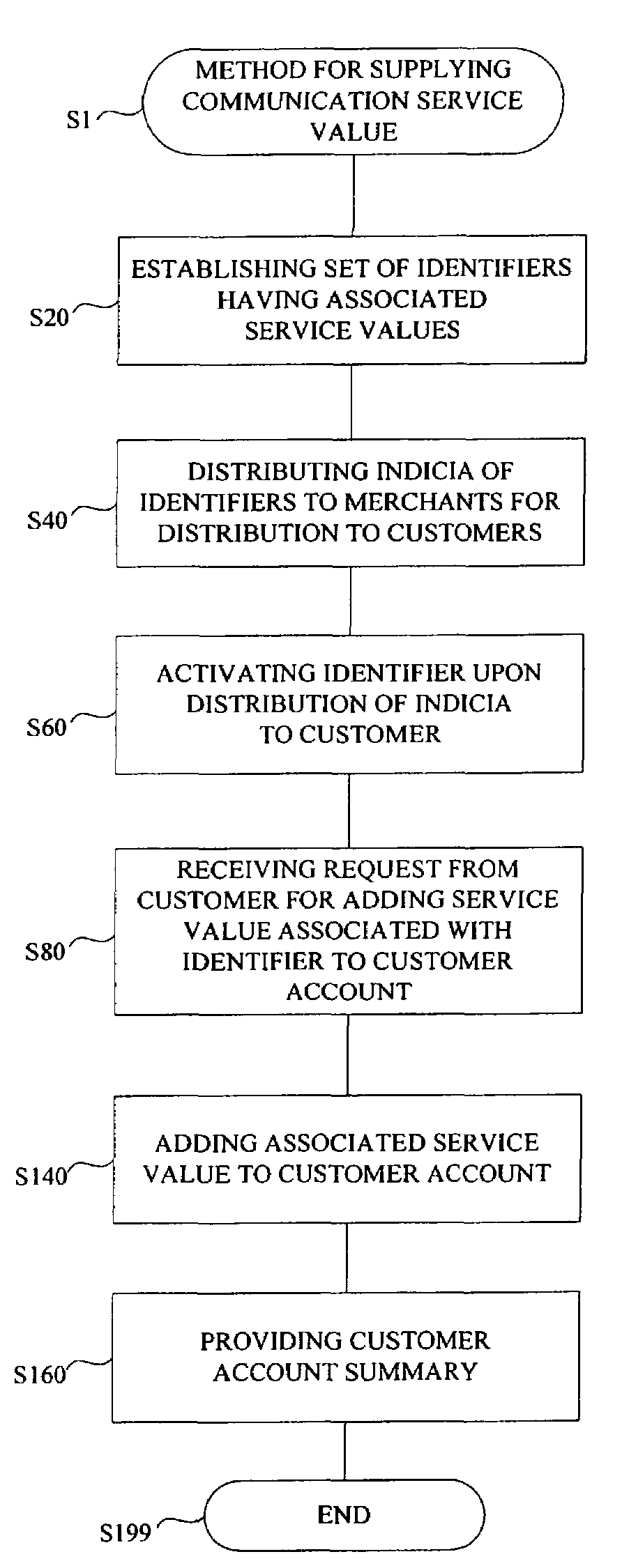

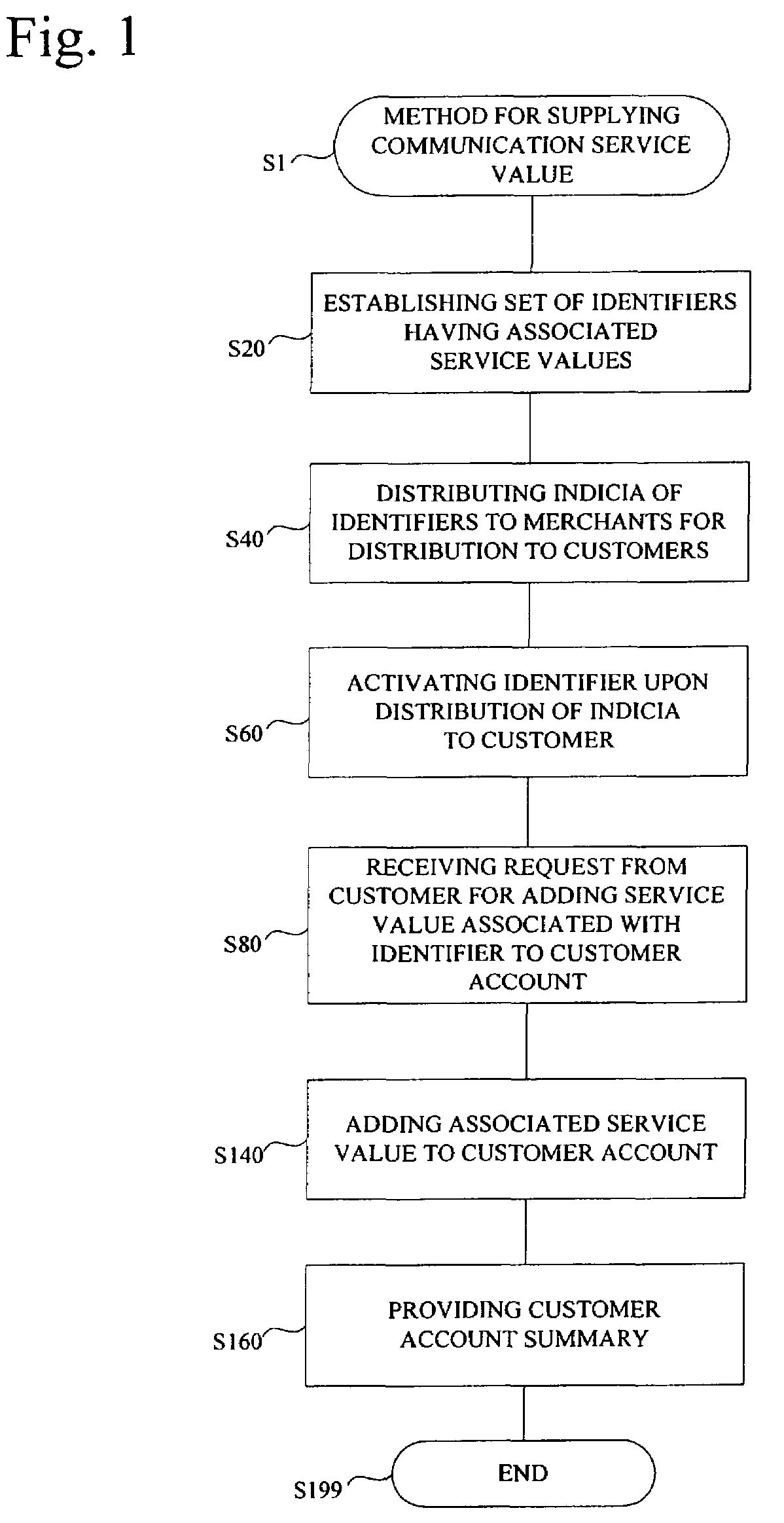

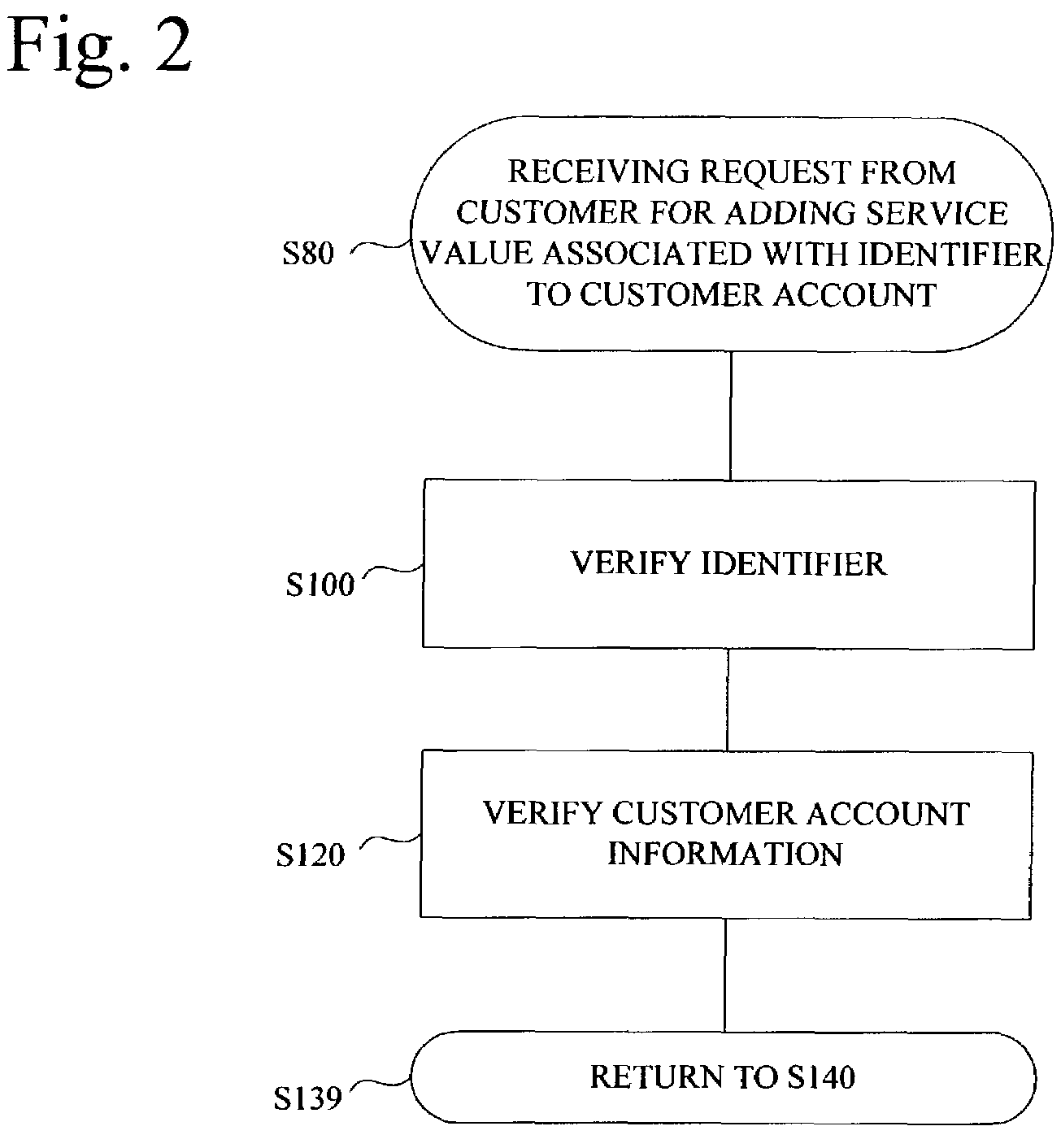

System and method for securing communication service

InactiveUS7333955B2Special data processing applicationsVerifying markings correctnessSecure communicationCarrier signal

A system and method for supplying communication service value is disclosed. In one embodiment, the method includes distributing indicia of an identifier to a merchant for distribution to a customer having a customer account. The identifier has an associated service value that is redeemable with a plurality of carriers. The method further includes activating the identifier upon distribution of the indicia to the customer, receiving a request from the customer to add the associated service value to the customer account, and adding the associated service value to the customer account is disclosed. In a further embodiment, the request includes identifier input and customer account input, and receiving a request from the customer to add the associated service value of the identifier to the customer account further includes verifying the identifier input and verifying the customer account input.

Owner:E2INTERACTIVE INC D B A E2INTERACTIVE

Method for inhibiting use of mobile communication terminal having memory where card information is stored, mobile communication network, and mobile communication terminal

InactiveUS20030045328A1Facilitate conductionEasy to processUnauthorised/fraudulent call preventionEavesdropping prevention circuitsPacket communicationCommunication interface

In a mobile communication network equipped with a wireless communication interface with a mobile communication terminal, when a need arises for disabling calling and card functions of a mobile communication terminal with a plurality of card information stored, there is provided a credit transaction system for permitting the process of disabling the calling and card functions of the mobile communication terminal, comprising a mobile station 100, a mobile telephone network 20, a mobile packet communication network 30, a CAT terminal 40a, 40b, . . . , the CAFIS network 50, acredit company's server 60A, 60B, and the Internet 70. Credit disablement flags are set in a control station 33, and the mobile station 100 receives a disabling signal from the control station 33 through a base station 31. The mobile station 100 subsequently deletes credit contract information stored in itself.

Owner:GOOGLE LLC

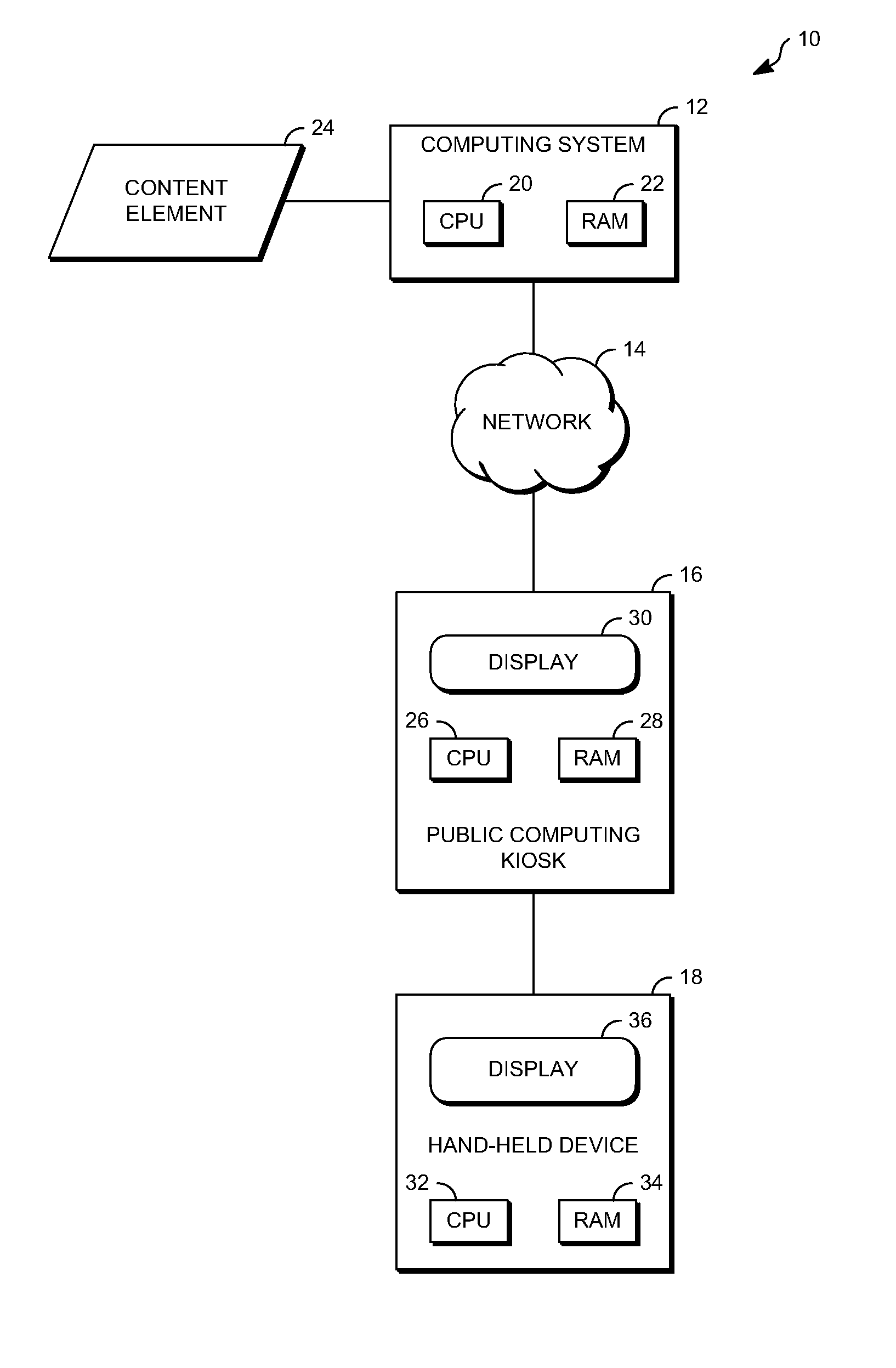

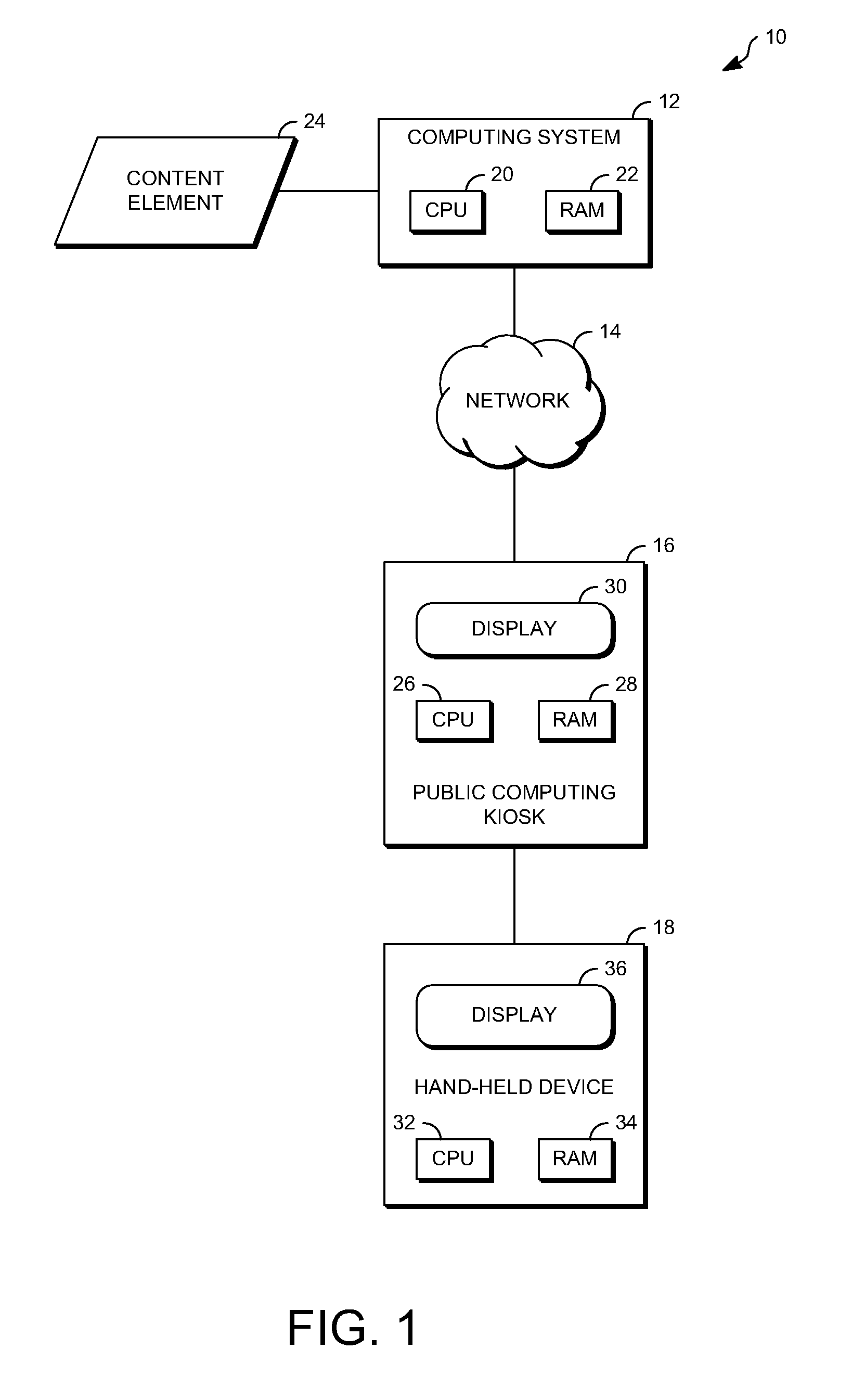

Public kiosk providing near field communication services

ActiveUS8180289B1Available for useNear-field transmissionData processing applicationsThird partyHand held

Systems and methods are disclosed for making content elements available for use at a public computing kiosk operated by a first-party operator. The public computing kiosk can receive a wireless communication from a hand-held device utilized by a second-party end user located in close physical proximity to the public computing kiosk. The wireless communication can include information identifying a third-party provider of the hand-held device with the third-party provider and the first-party operator being different entities. The public computing kiosk can transmit a request to a computing system including information identifying the third-party provider of the hand-held device, receive a transmission including a set of content descriptors, and display the set of content descriptors to the second-party end user. The public computing kiosk can also accept selection of content descriptors and execute at least one content element corresponding to at least one content descriptor.

Owner:GOOGLE LLC

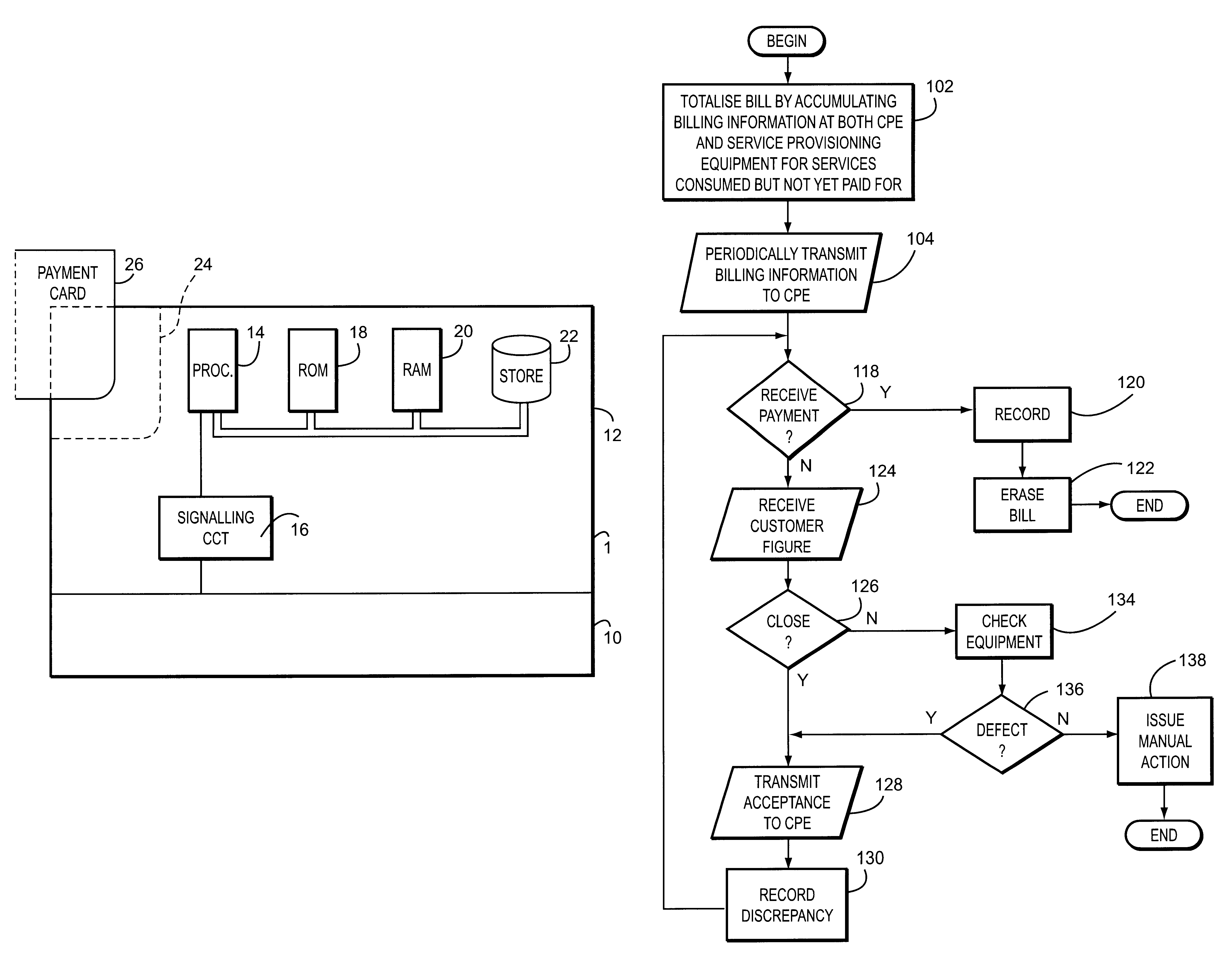

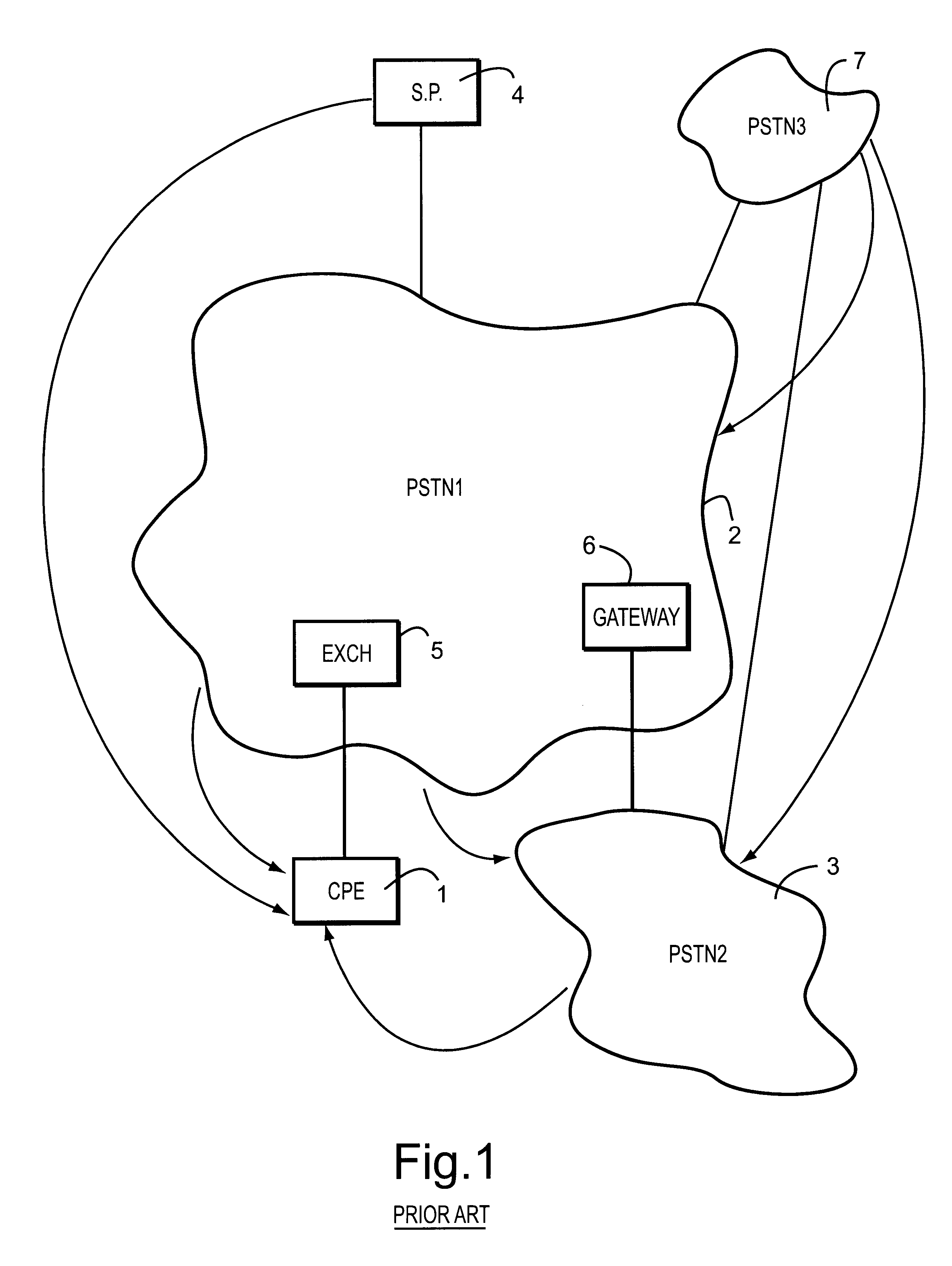

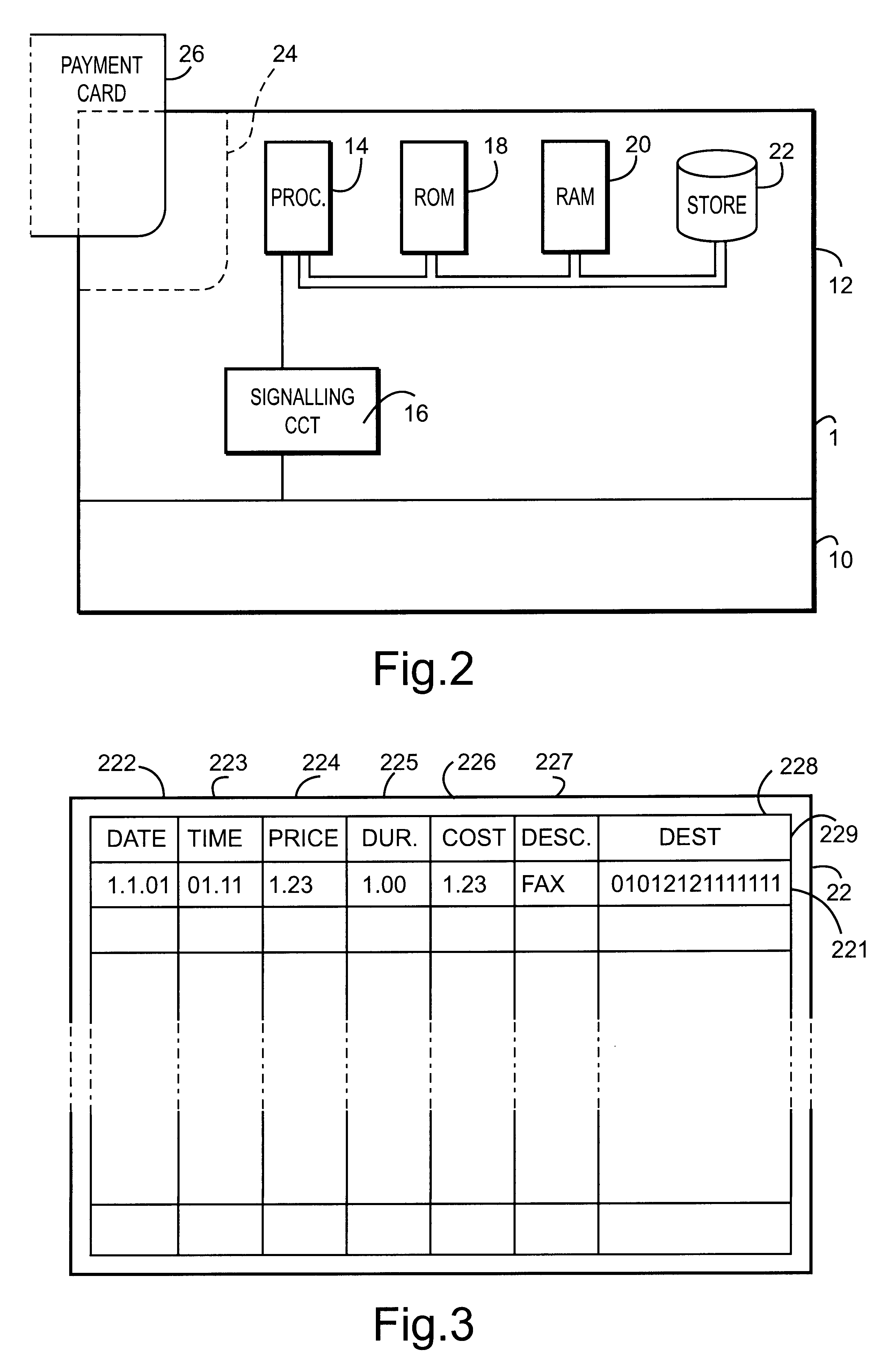

Accounting system in a communication network

InactiveUS6577858B1Big amount of dataEasy to rely onAccounting/billing servicesSpecial service for subscribersPaymentCommunications system

A communication system includes a communication utilizing apparatus connectable to a communications network and service provision apparatus for making services available to the communications utilizing apparatus. An accounting device is associated with the communications utilizing apparatus and includes a digital data storage device arranged to store details of the receipt of services by the communications utilizing apparatus a signalling circuit arranged to receive, via the communications network, signals indicating a payment due in respect of services provided by the service provision apparatus, and a comparison device arranged to compare the received indications with data derived from the stored details.

Owner:BRITISH TELECOMM PLC

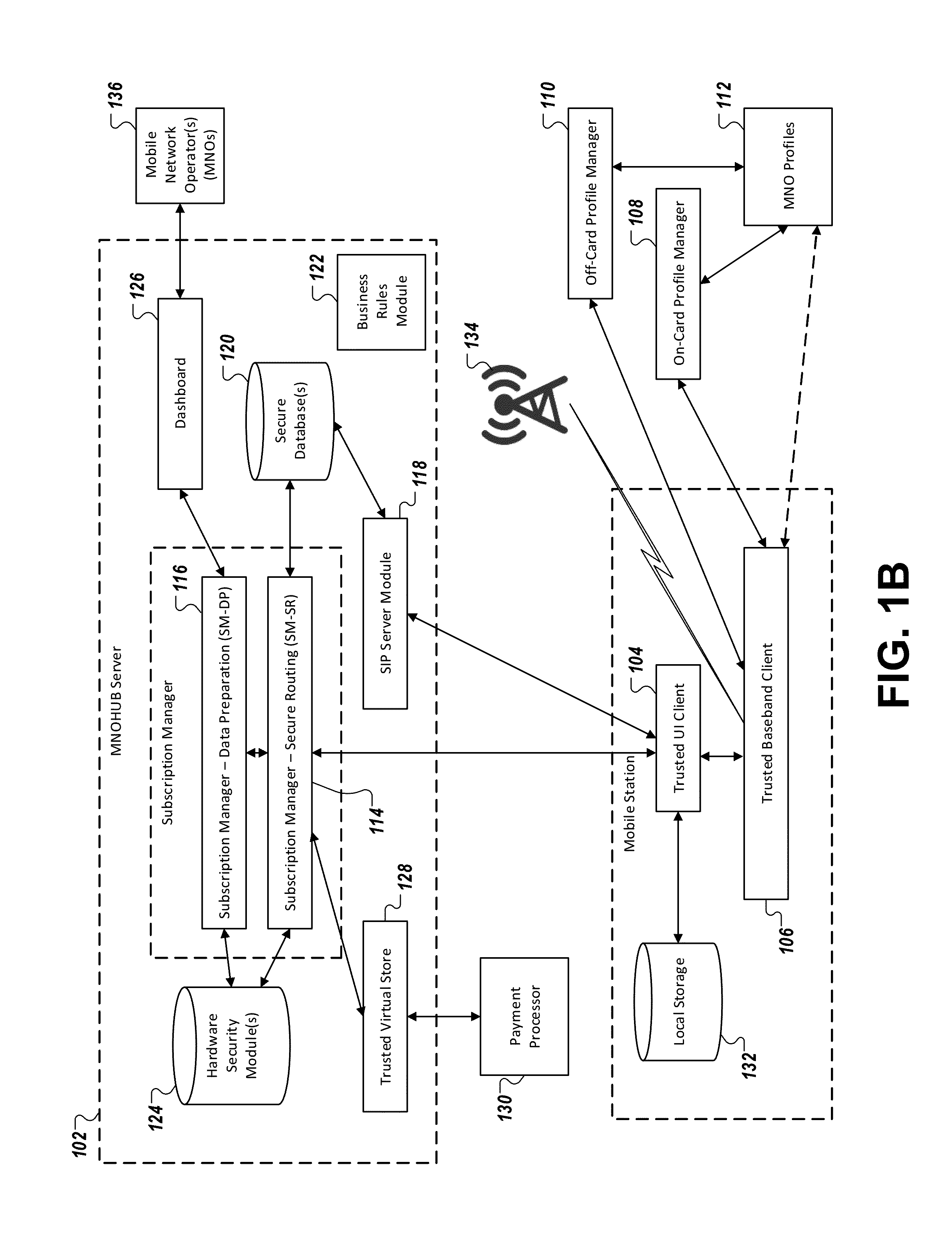

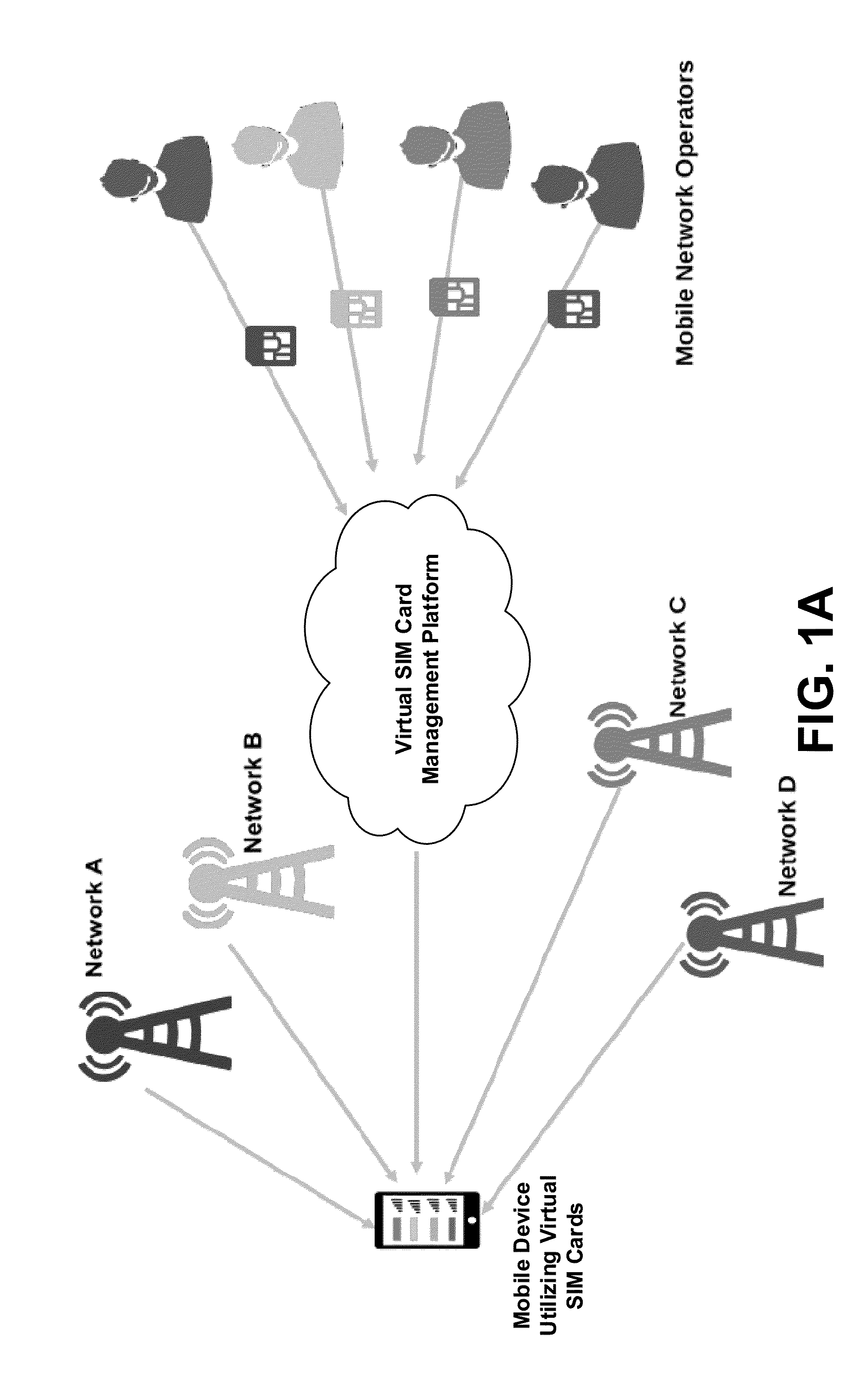

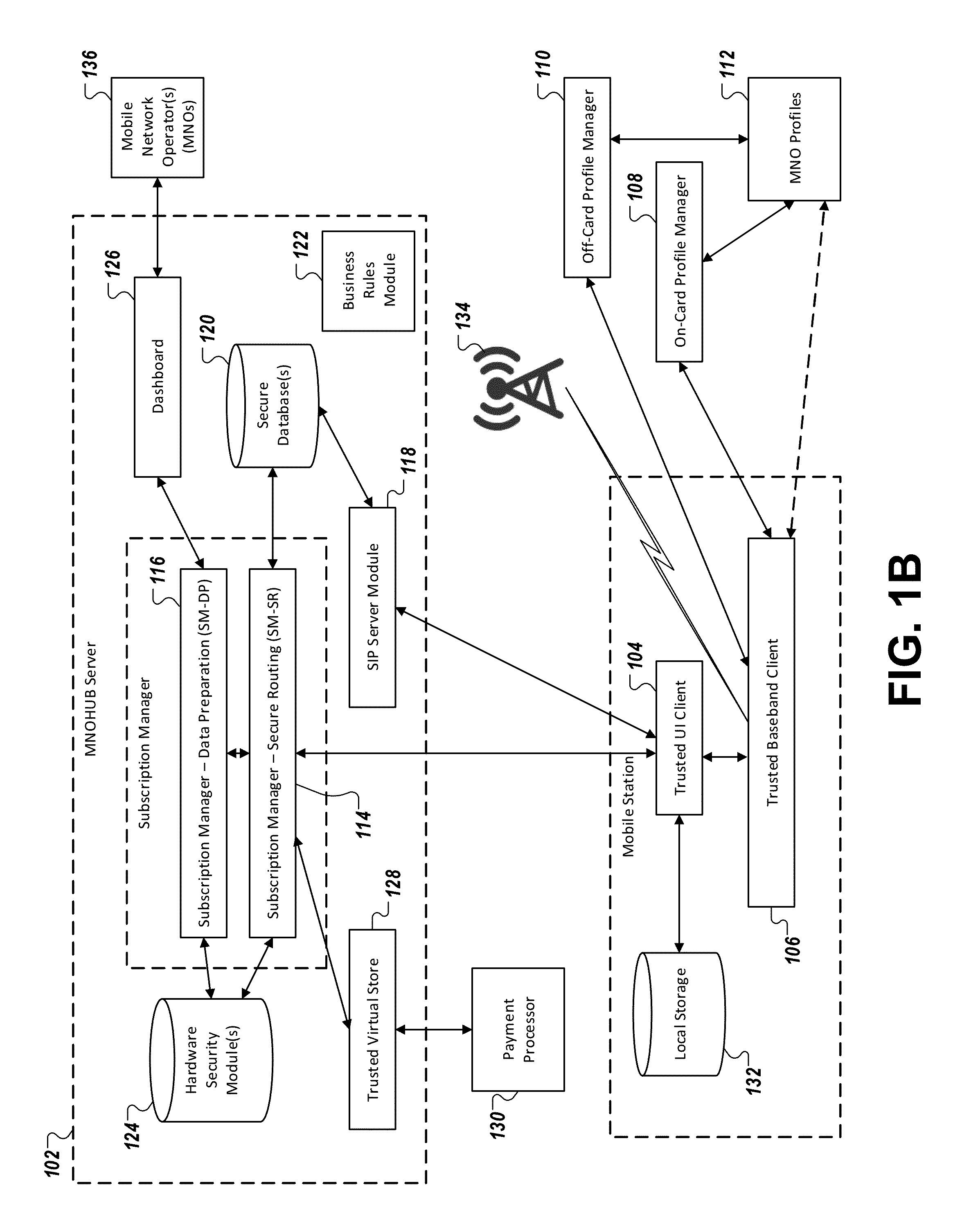

Apparatuses, methods and systems for interfacing with a trusted subscription management platform

ActiveUS20160007190A1Improve communication experienceService provisioningAccounting/billing servicesSession Initiation ProtocolVirtualization

Apparatuses, methods, and systems are provided for implementing a trusted subscription management platform. The platform allows the remote creation, distribution and management of virtual subscriber identity module cards stored in a plurality of concurrent embedded Universal Integrated Circuit Cards (eUICCs). The eUICCs may be virtualized through a secure software module integrated within a mobile station or in a distant server. These eUICCs may be deployed in both hardware and software instances within the mobile station (or the distant server). In some embodiments, use of the trusted subscription management platform provides a Session Initiation Protocol (SIP) server module that facilitates the transmission of voice and data over Internet protocol services integrated within a phone application of the mobile station.

Owner:GIGSKY

Apparatuses, methods and systems for implementing a trusted subscription management platform

ActiveUS20160007188A1Improve communication experienceService provisioningAccounting/billing servicesComputer hardwareClient-side

Apparatuses, methods, and computer readable storage media are provided for implementing a trusted subscription management platform. An example server device is configured to transmit, to a trusted UI client of a mobile station, information regarding a set of virtual SIM cards associated with the mobile station, and receive, from the trusted UI client of the mobile station, a request to provision a particular virtual SIM card. The server device is further configured to initiate, by an SM-SR module and via a trusted baseband client of the mobile device, a secure proxy channel between the server device and a profile manager that hosts the particular virtual SIM card, and transmit, via the secure proxy channel and to the profile manager, an instruction regarding the particular virtual SIM card. Corresponding methods and computer readable storage media are provided.

Owner:GIGSKY

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com