Patents

Literature

331 results about "Online transaction processing" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

In Online transaction processing (OLTP), information systems typically facilitate and manage transaction-oriented applications. The term "transaction" can have two different meanings, both of which might apply: in the realm of computers or database transactions it denotes an atomic change of state, whereas in the realm of business or finance, the term typically denotes an exchange of economic entities (as used by, e.g., Transaction Processing Performance Council or commercial transactions.) OLTP may use transactions of the first type to record transactions of the second.

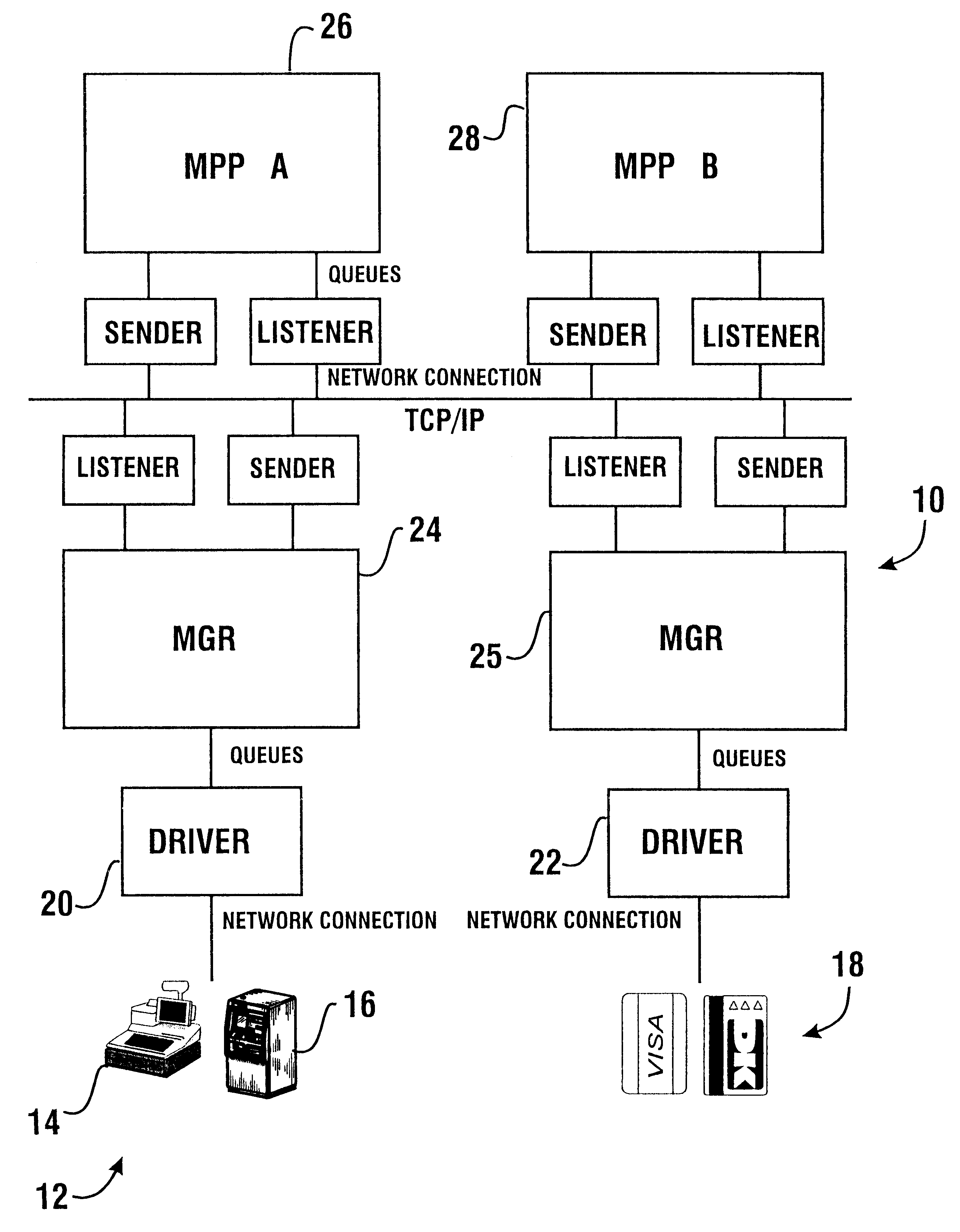

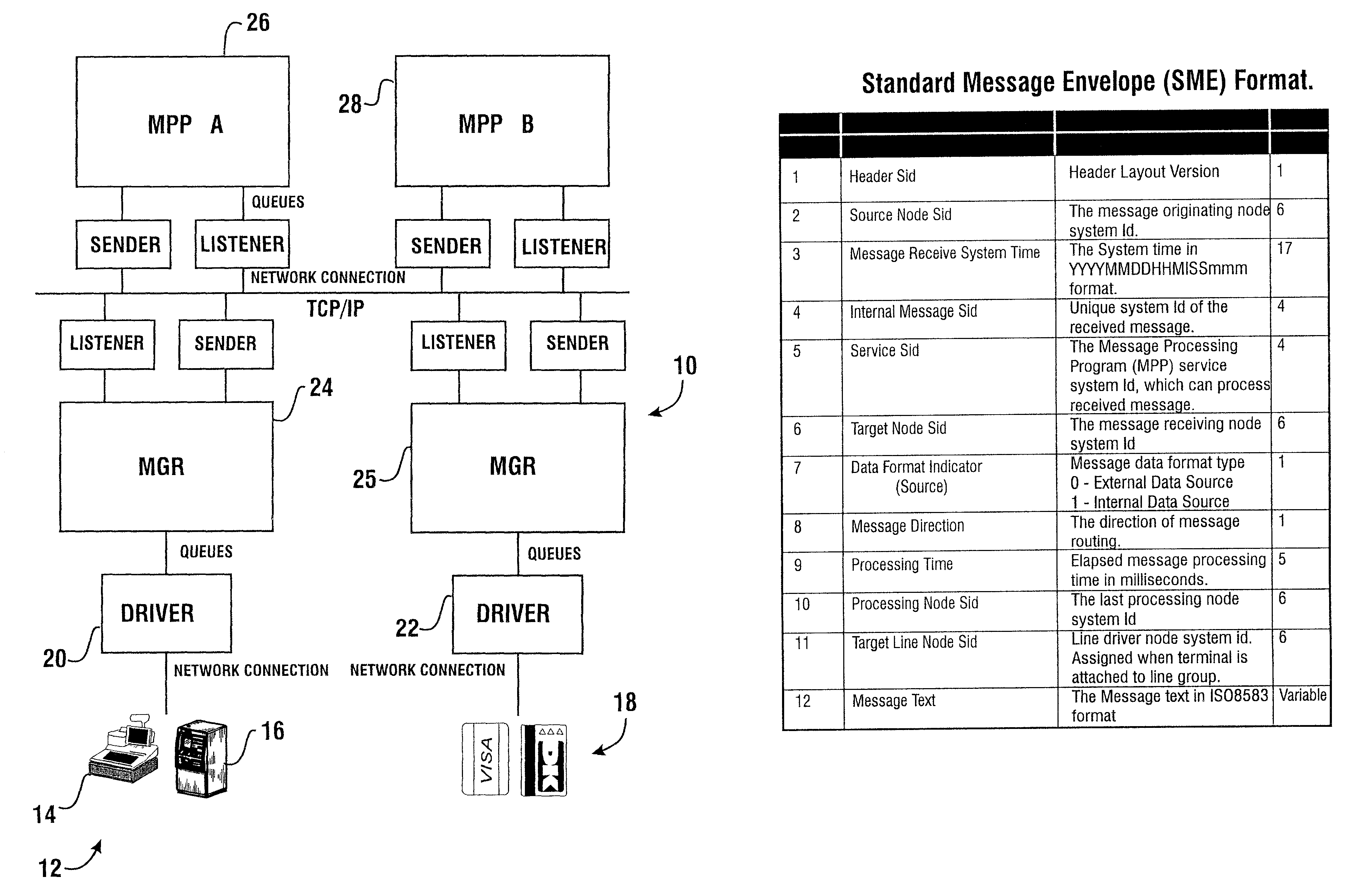

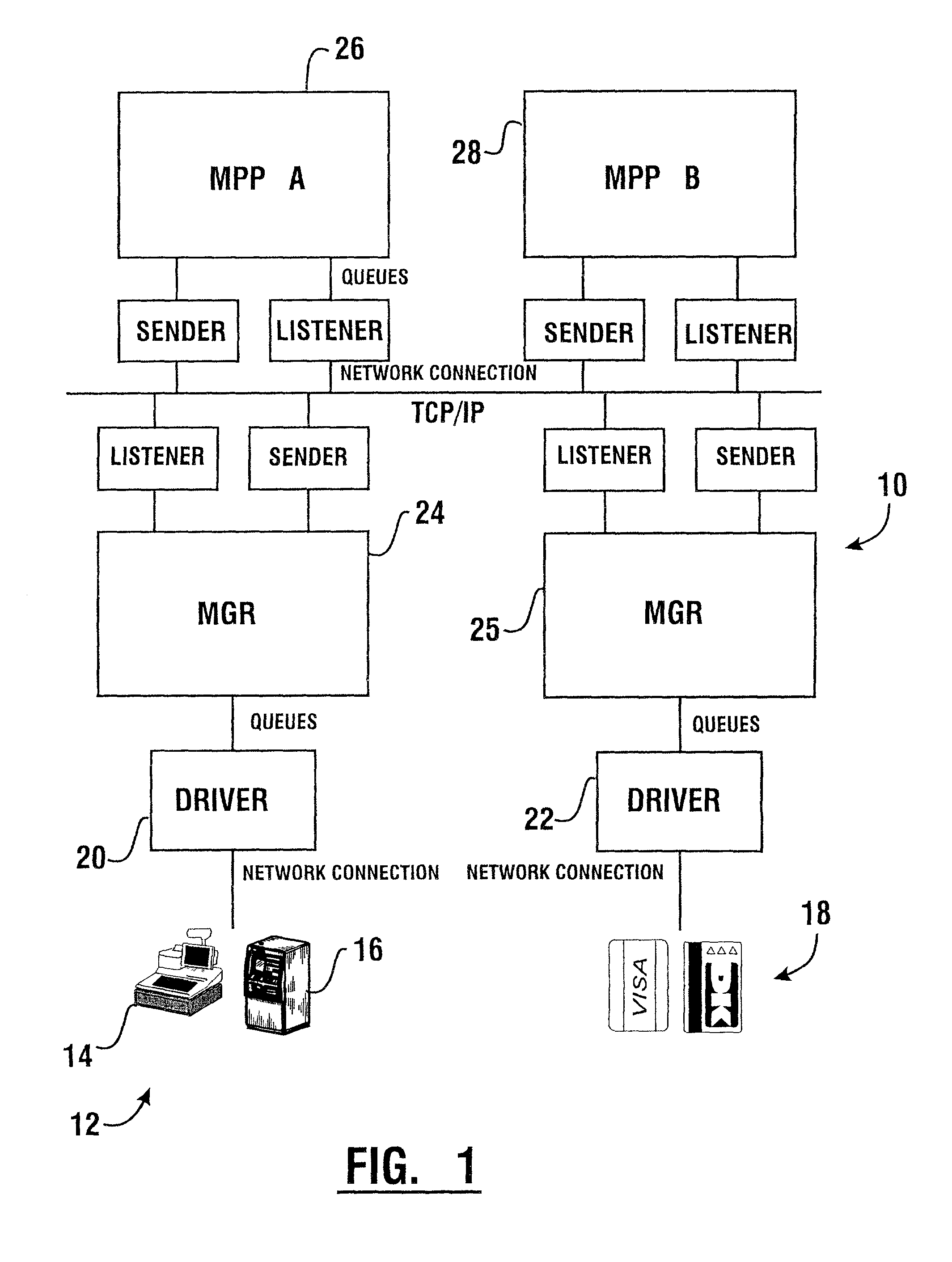

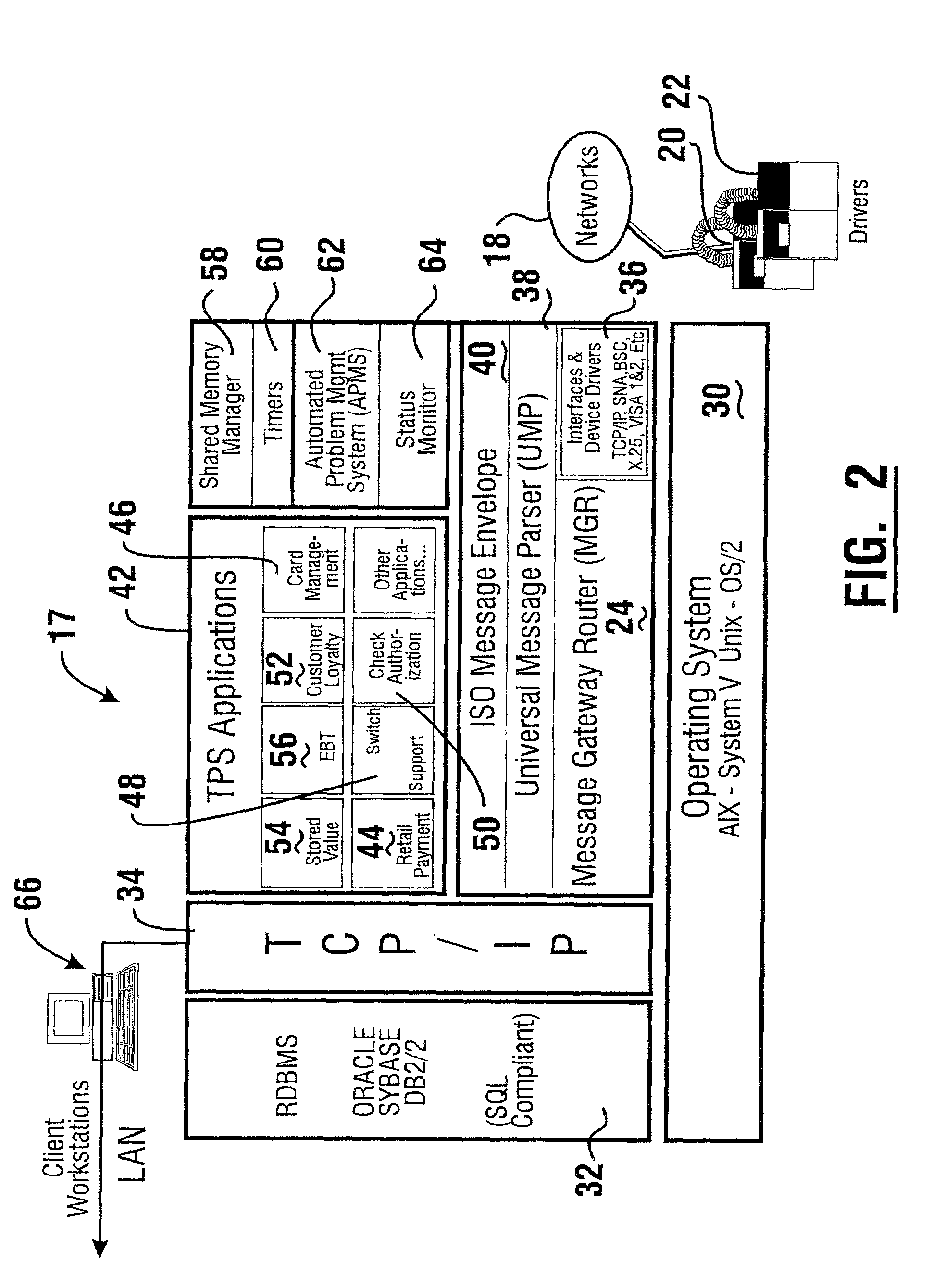

Financial transaction processing system and method

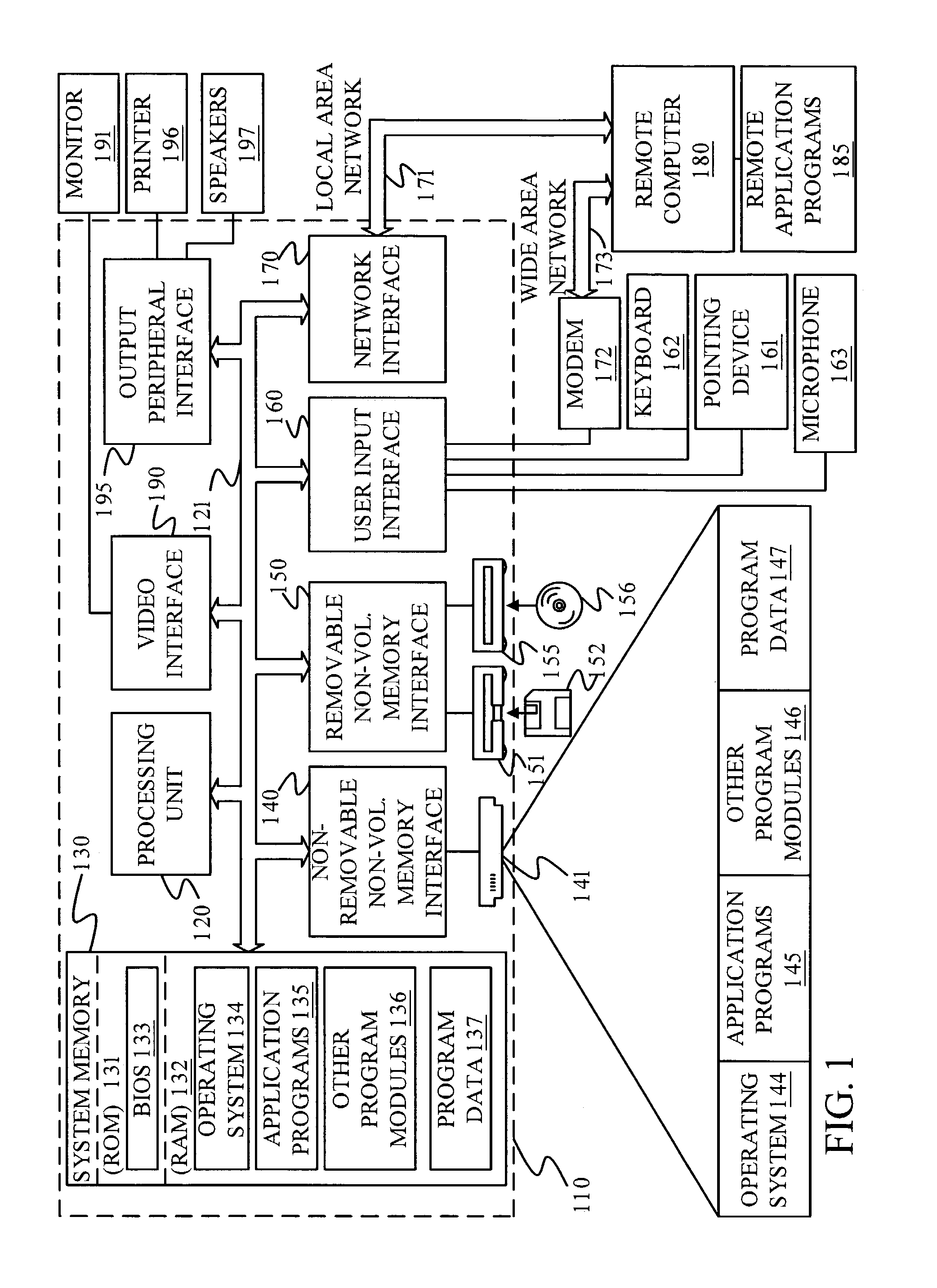

InactiveUS6039245AEasy to develop and modifyEasy to changeComplete banking machinesHand manipulated computer devicesRelational databaseTerminal equipment

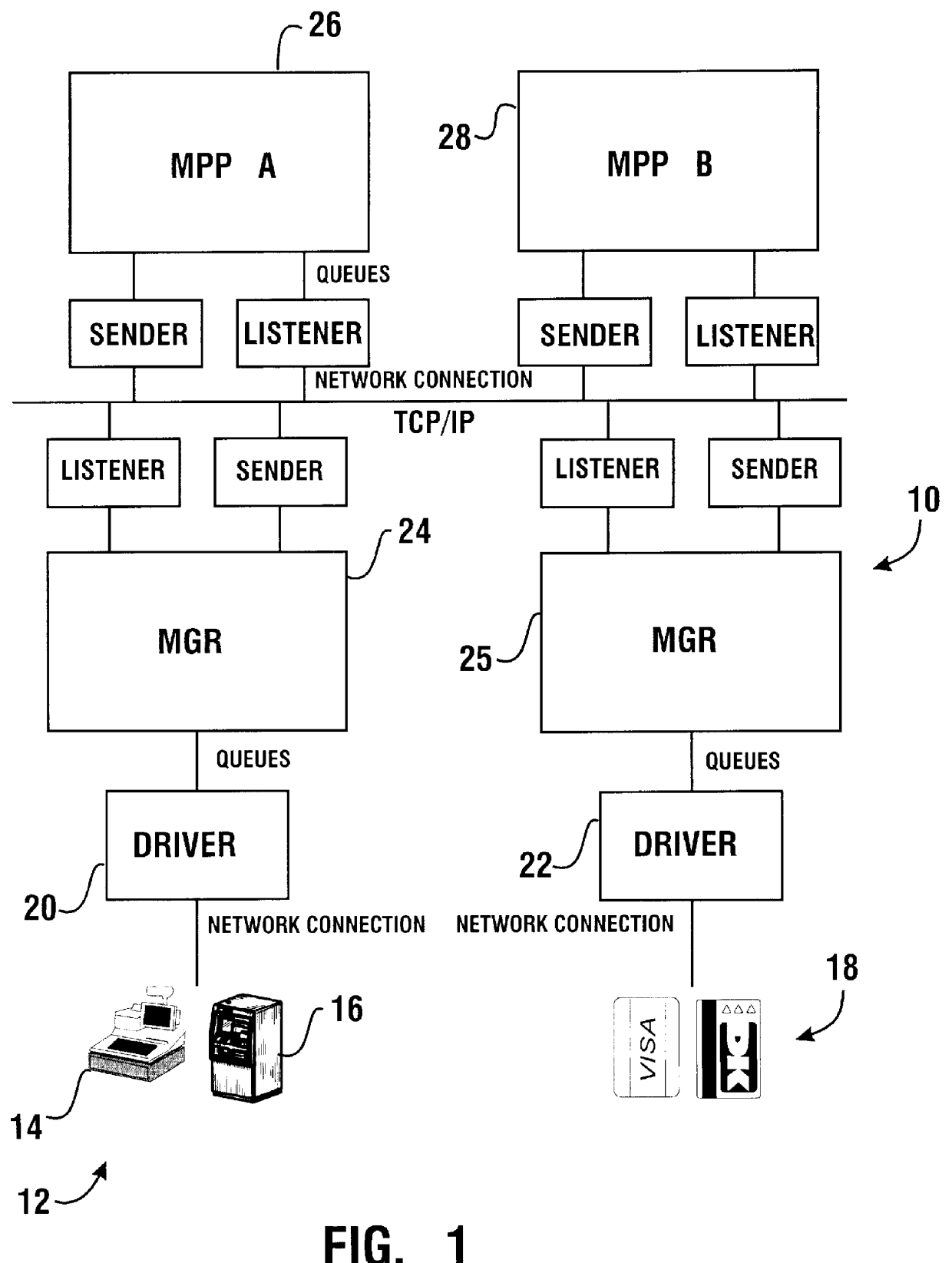

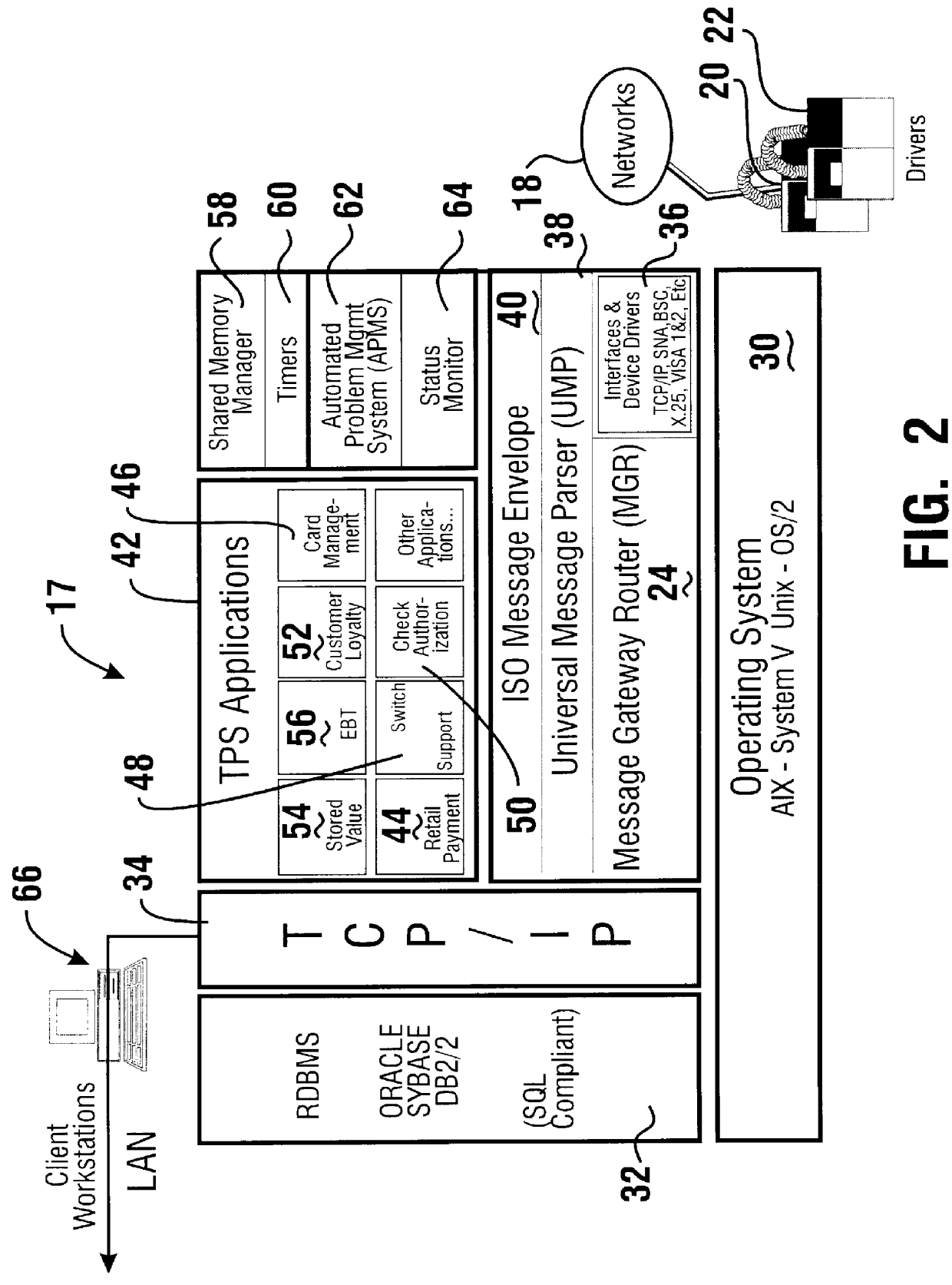

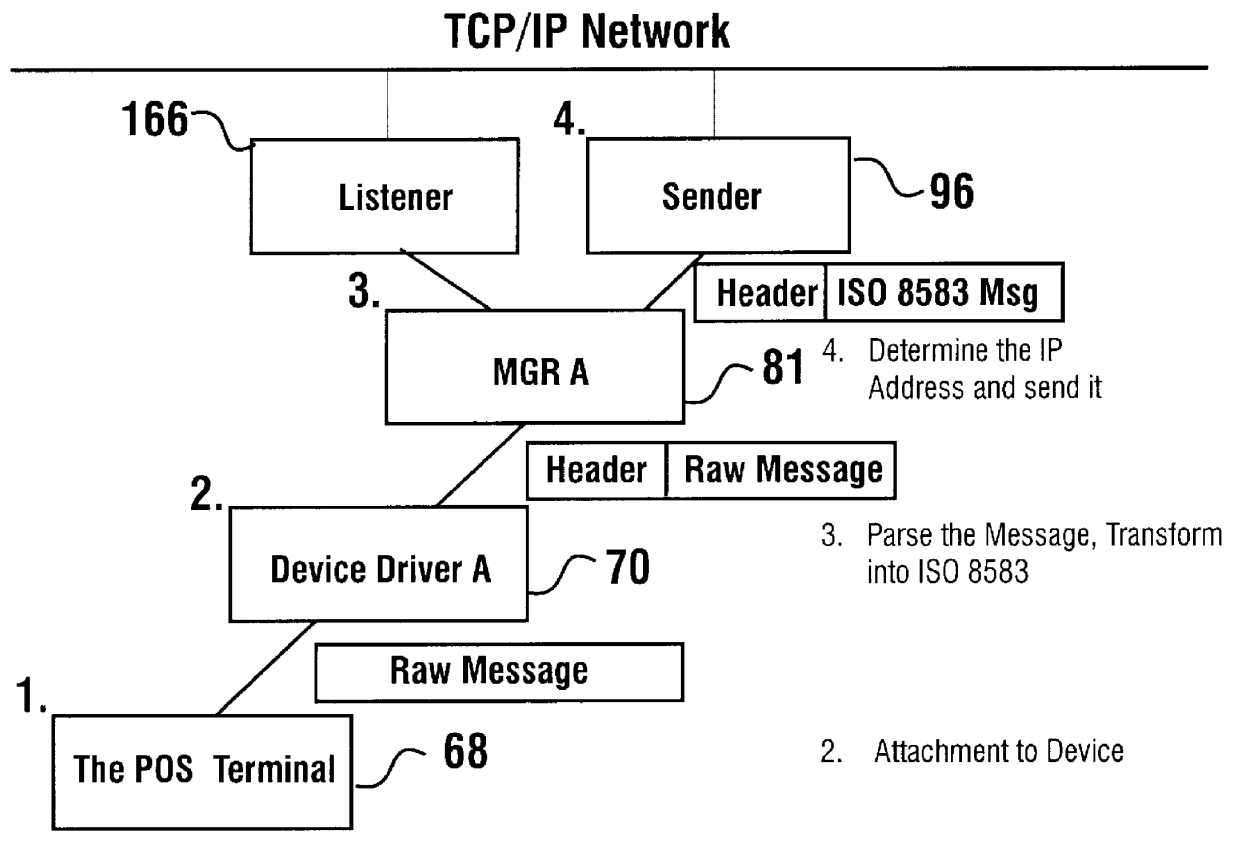

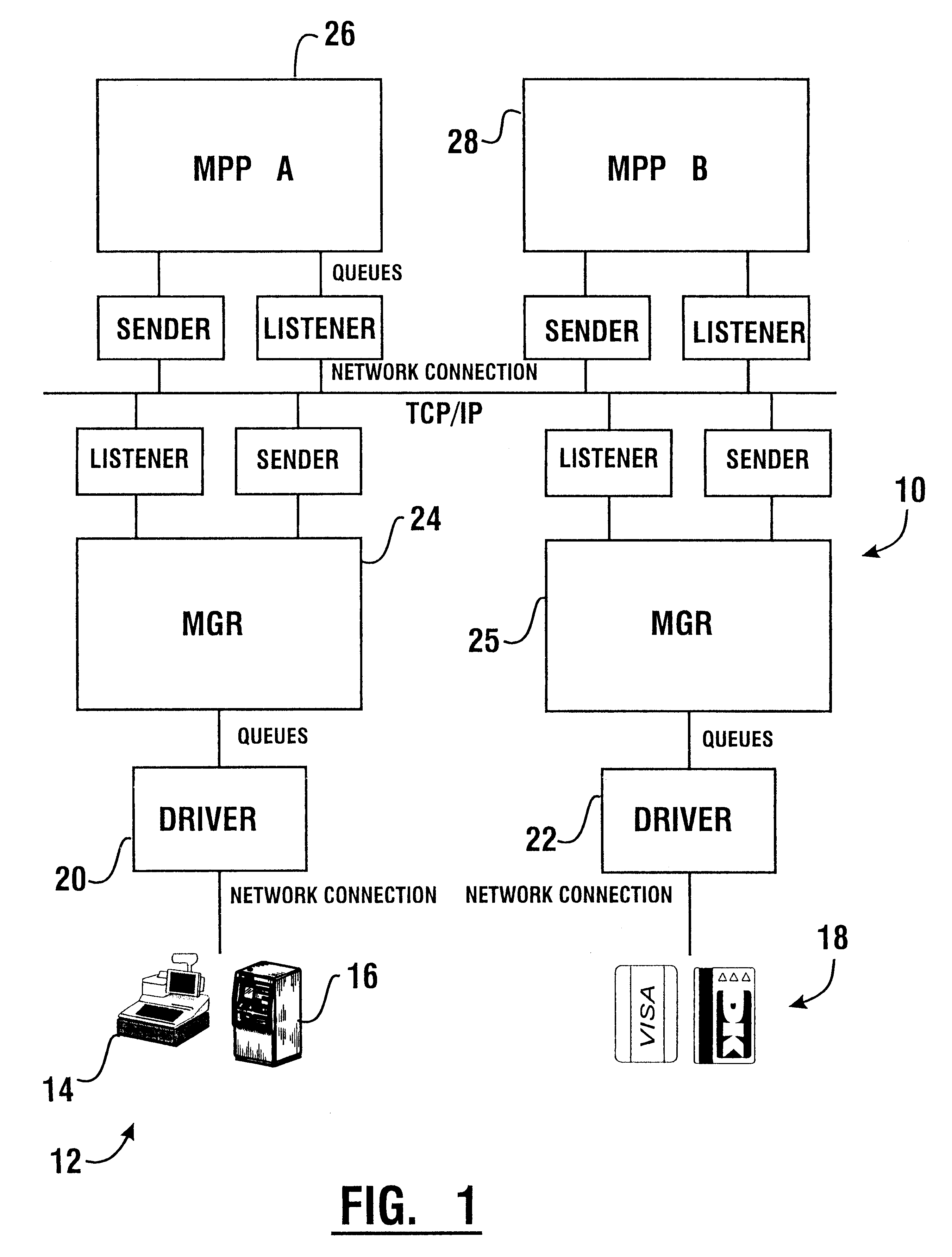

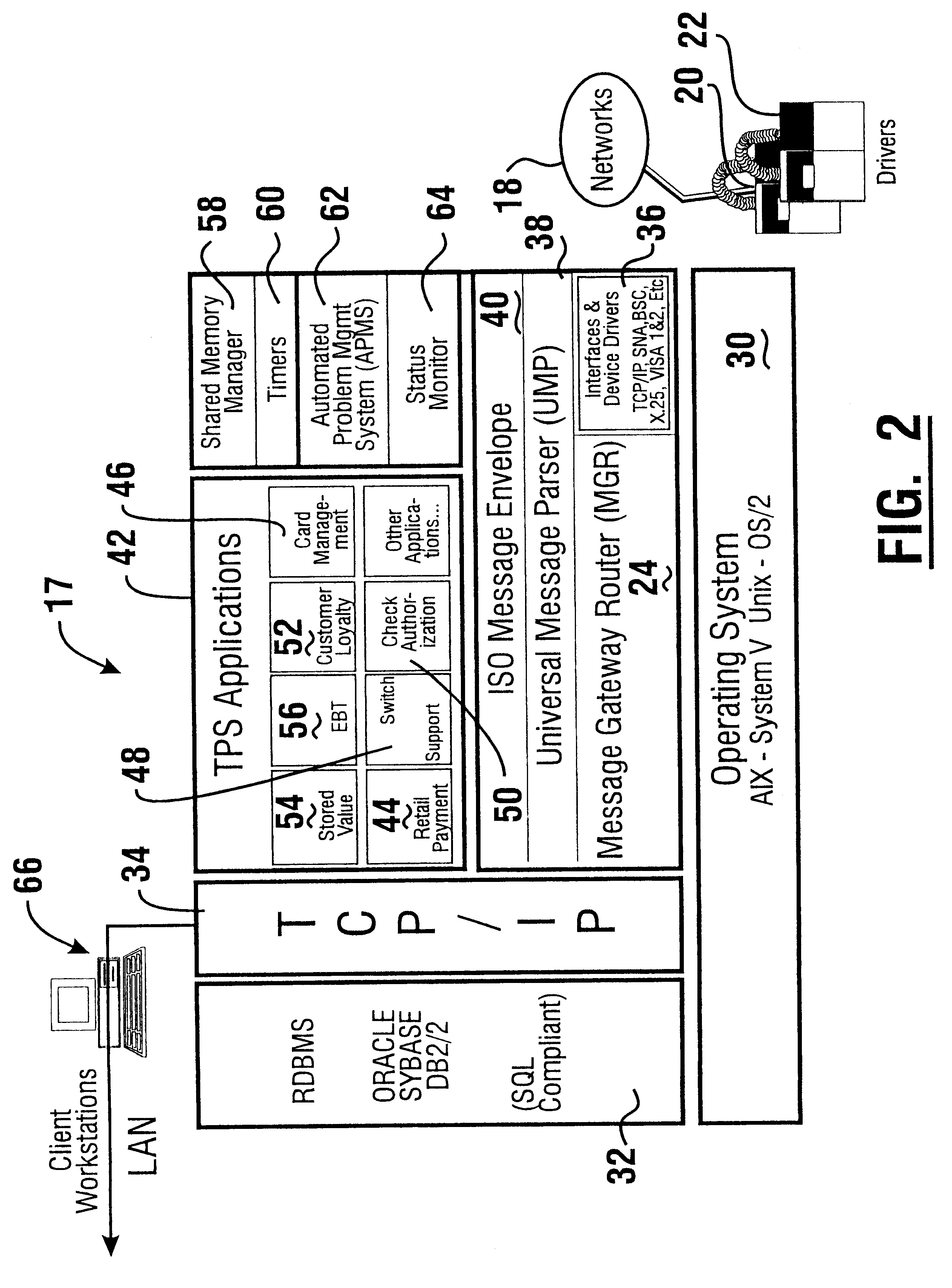

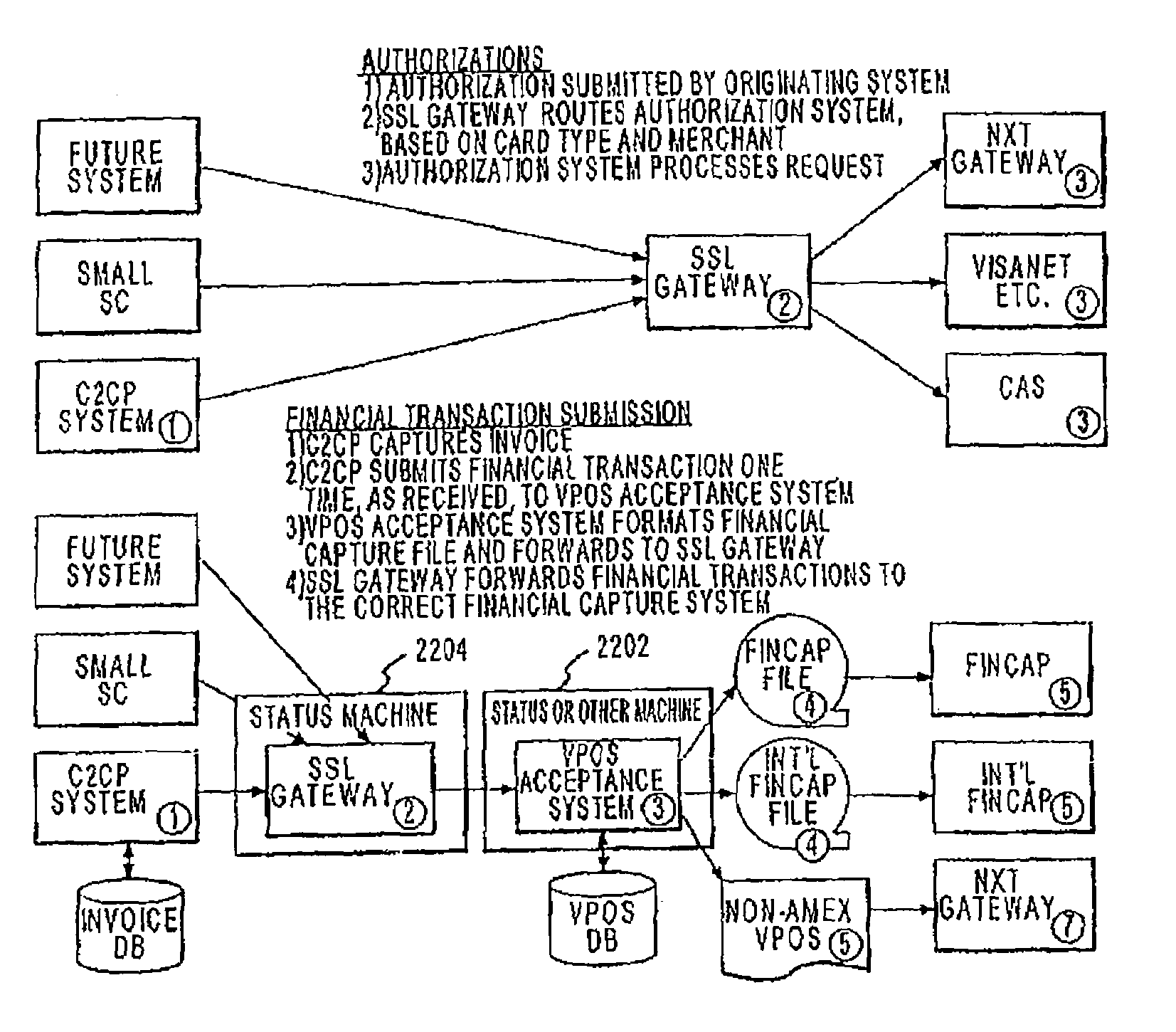

A financial transaction processing system (10) enables processing transactions from various types of card activated terminal devices (12) which communicate using a variety of electronic message formats. The transaction processing system may operate to authorize transactions internally using information stored in a relational database (32) or may communicate with external authorization systems (18). The transaction processing system includes among its software components message gateway routers (MGRs) (24, 164) which operate using information stored in the relational database to convert messages from a variety of external message formats used by the external devices and authorization systems, to a common internal message format used within the system. The system further uses database information to internally route messages to message processing programs (MPPs) (108, 138) which process messages and generate messages to the external devices and authorization systems. The MGR also converts the outgoing messages from the internal message format to the external message formats which can be interpreted by the external devices and systems to which the messages are directed.

Owner:DIEBOLD NIXDORF

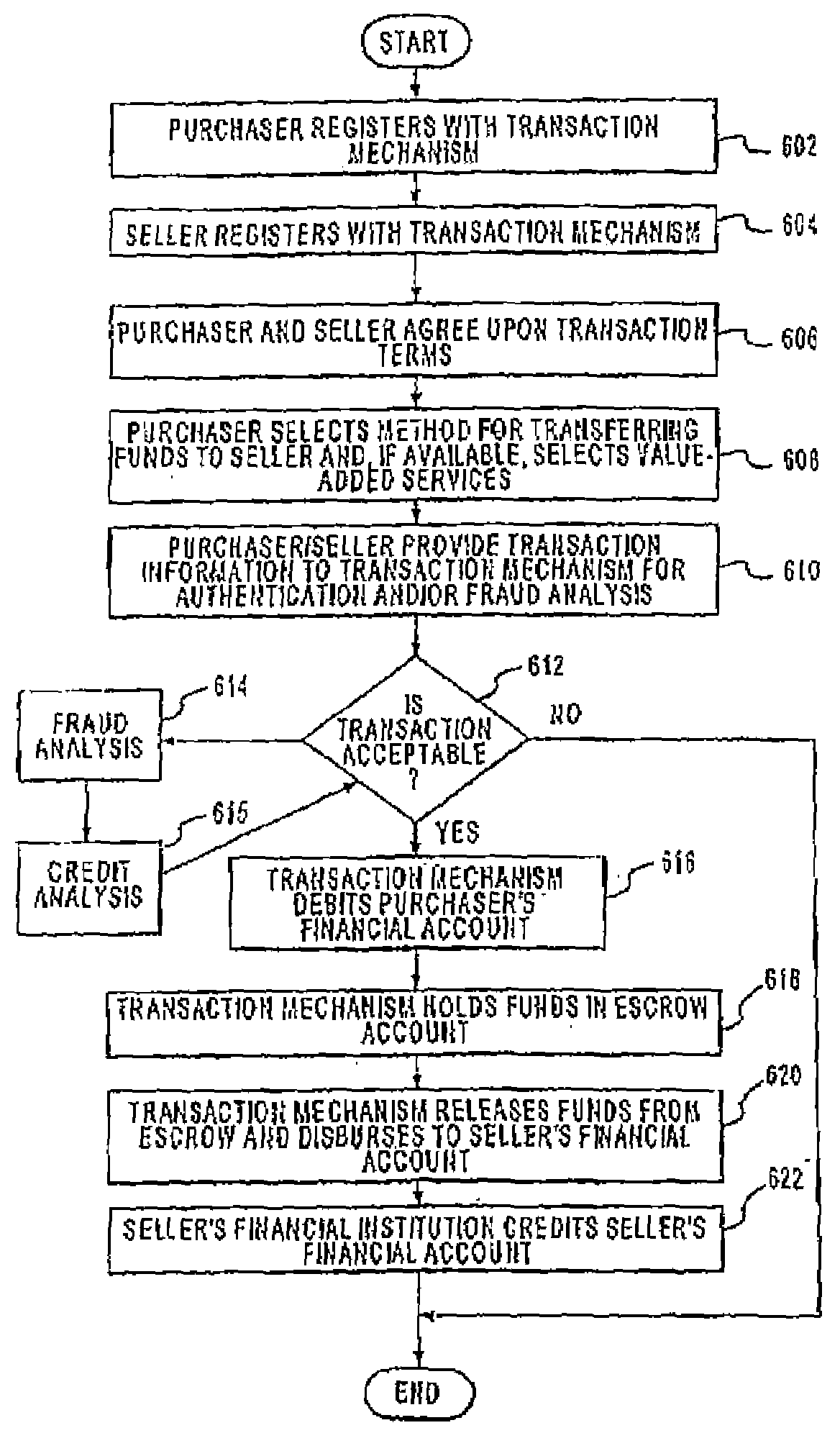

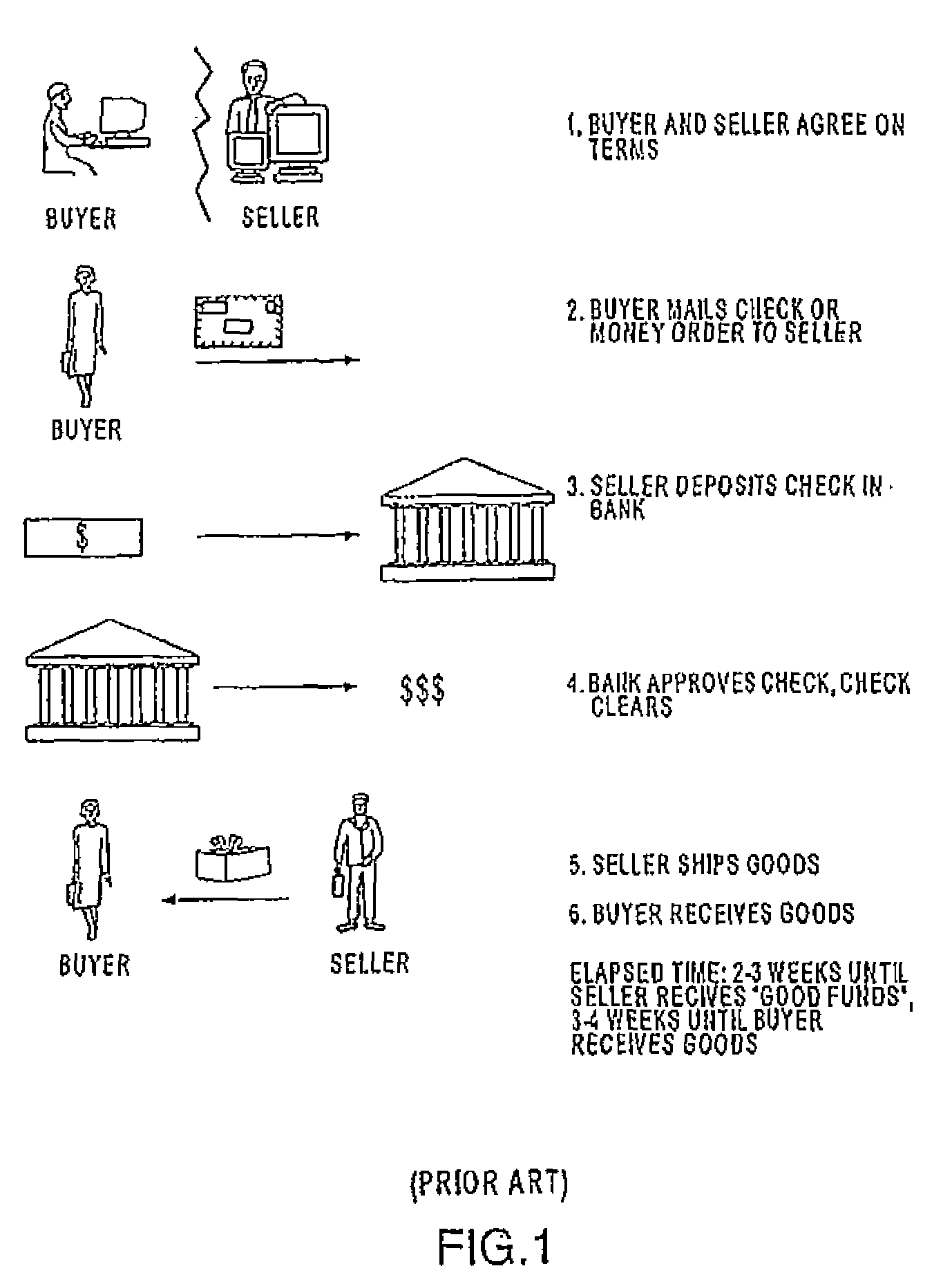

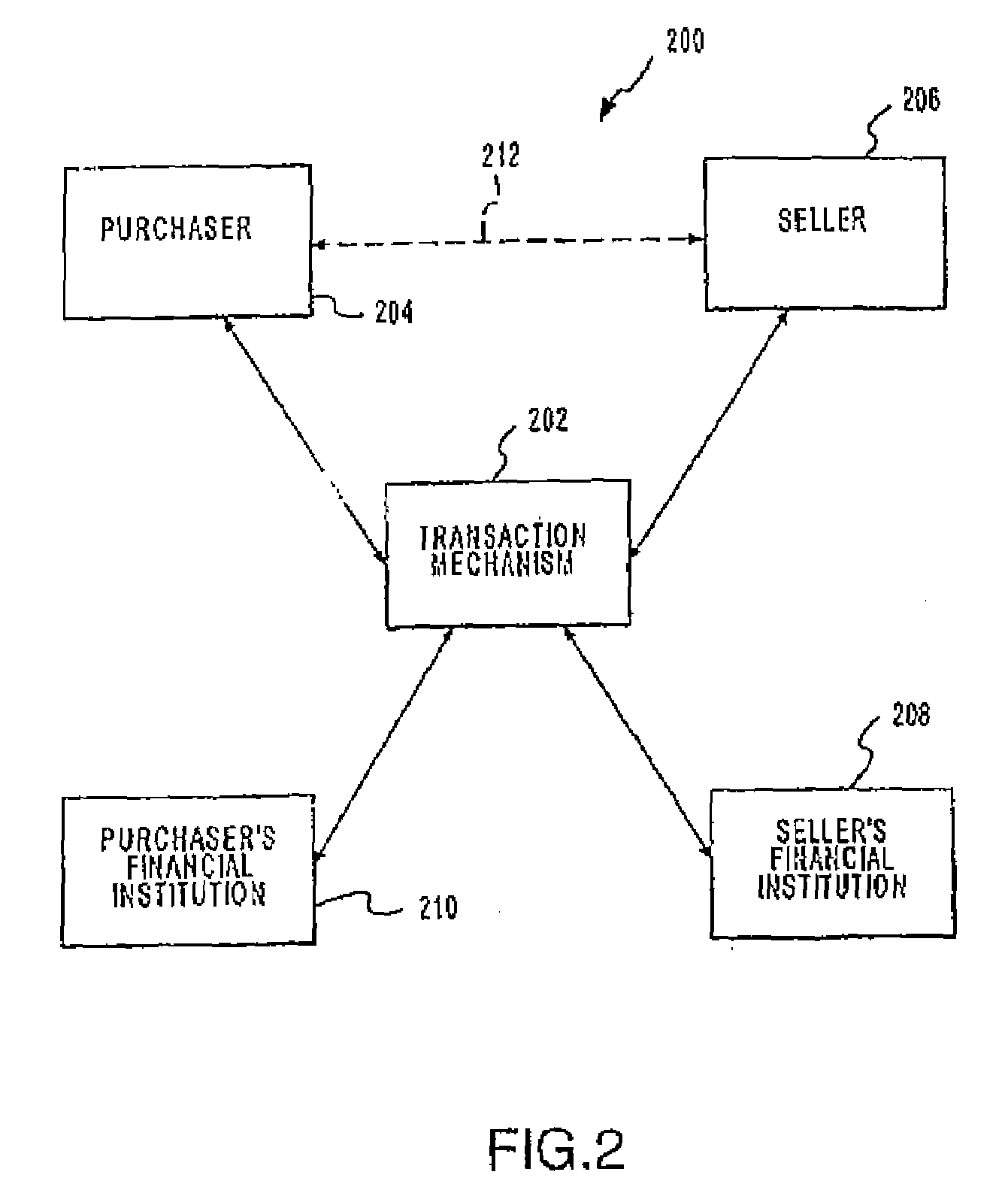

Methods and systems for online transaction processing

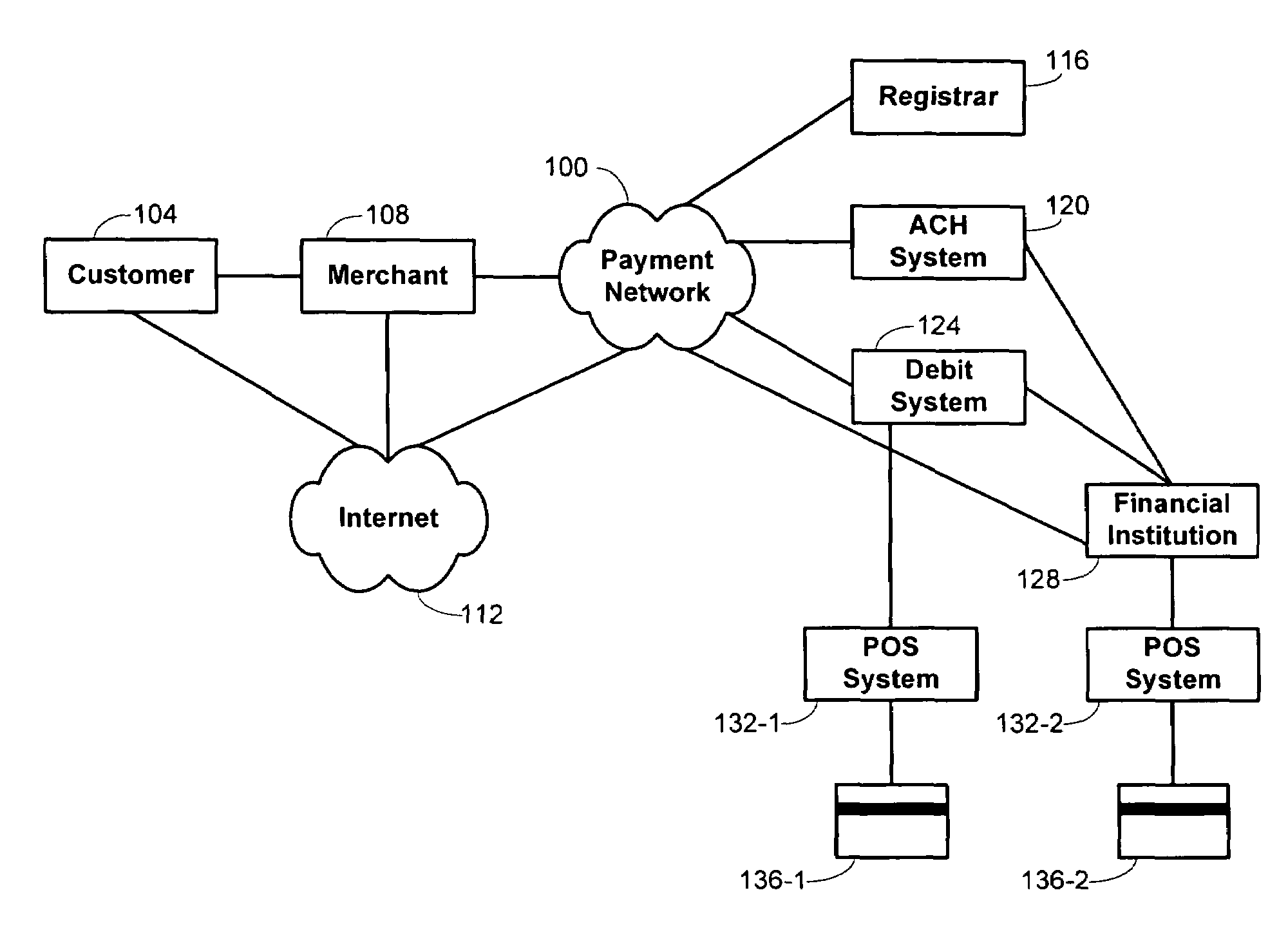

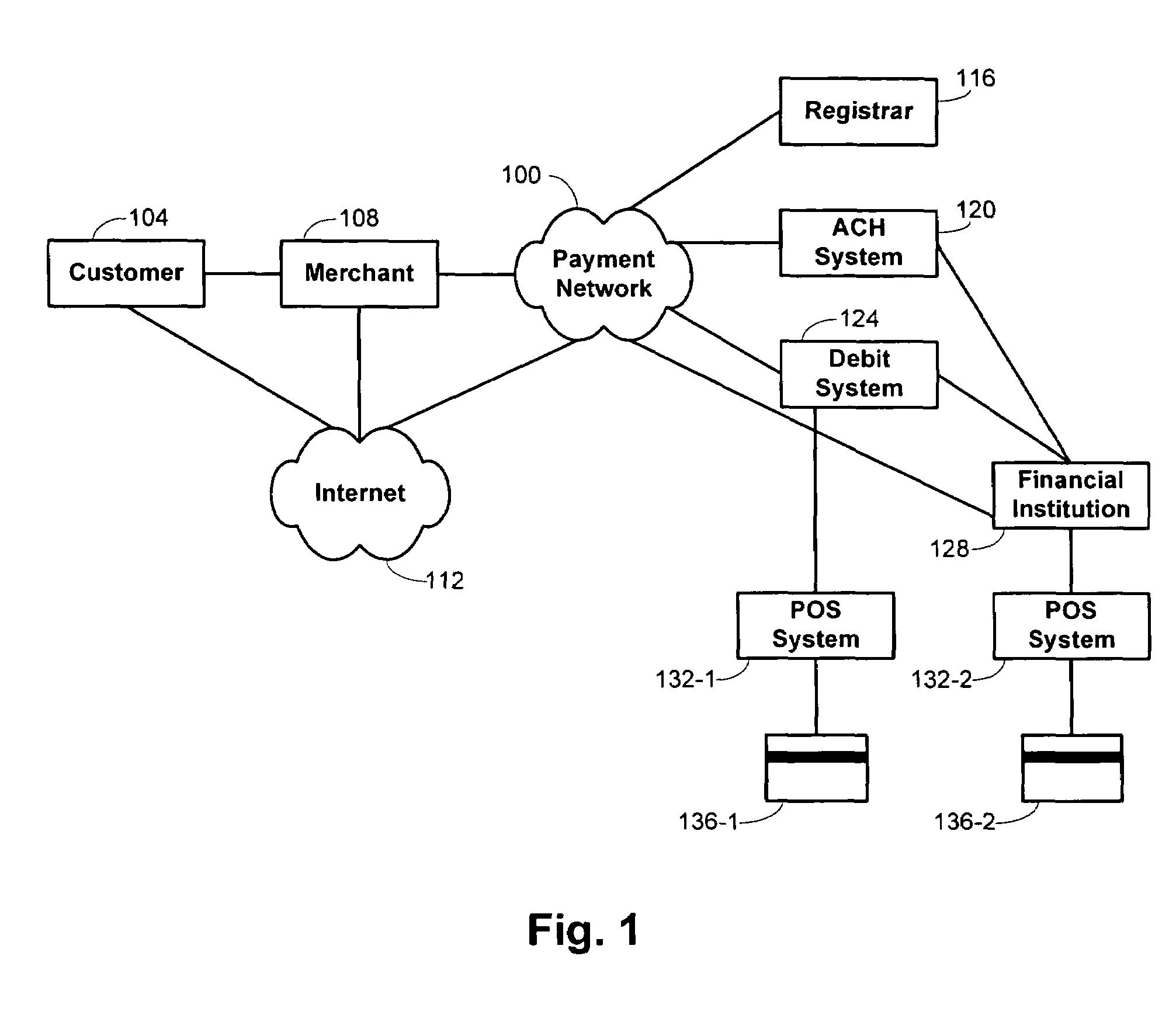

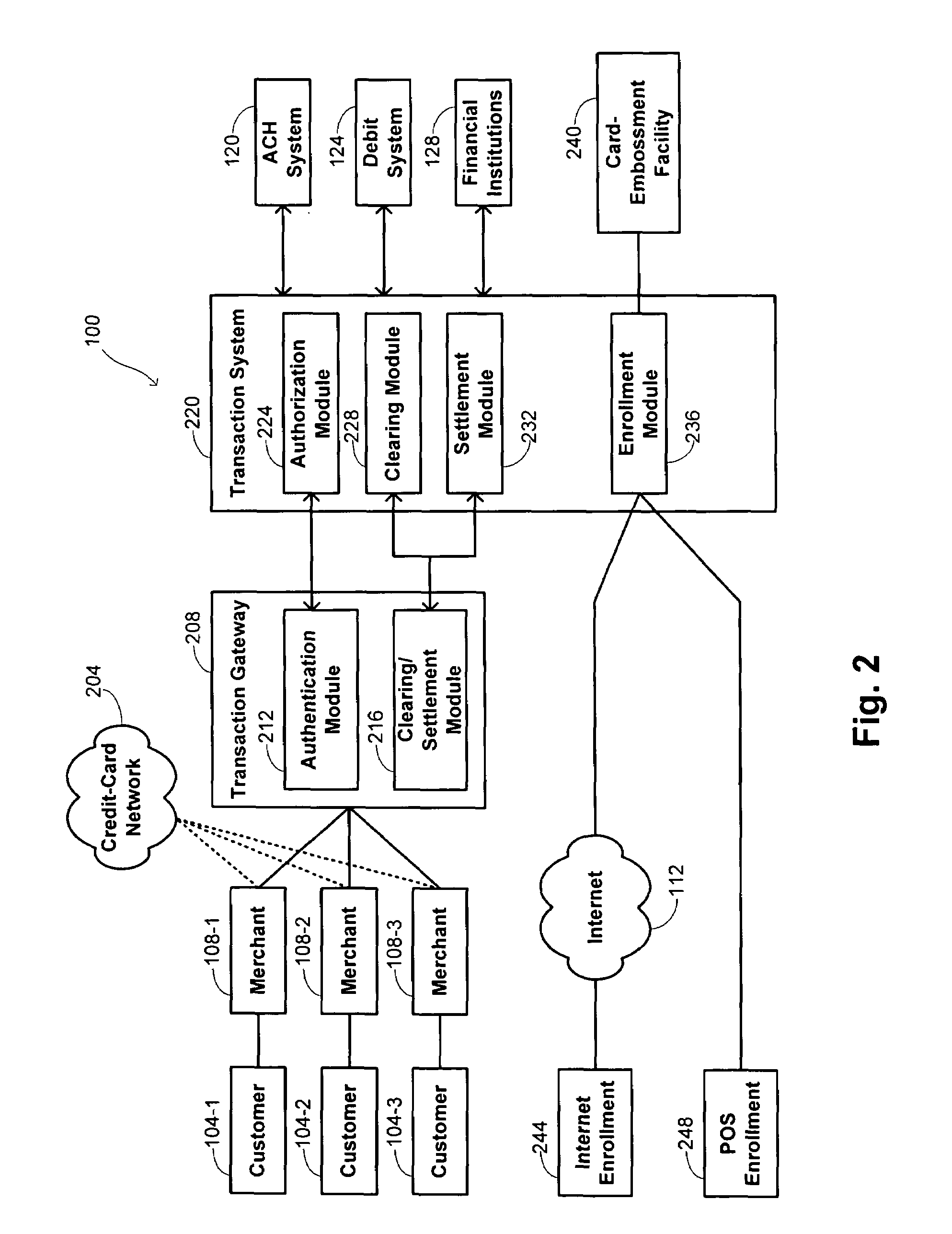

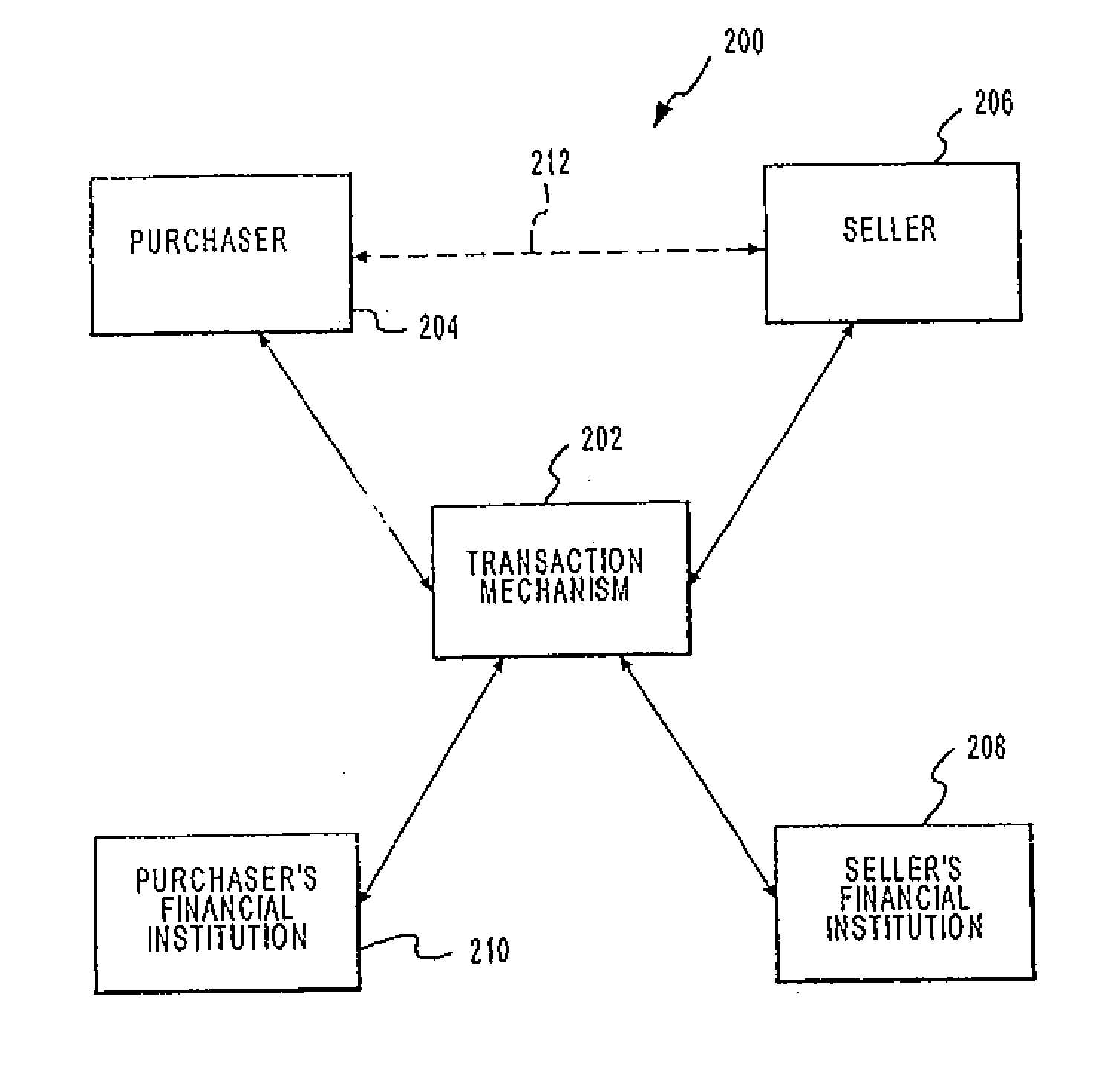

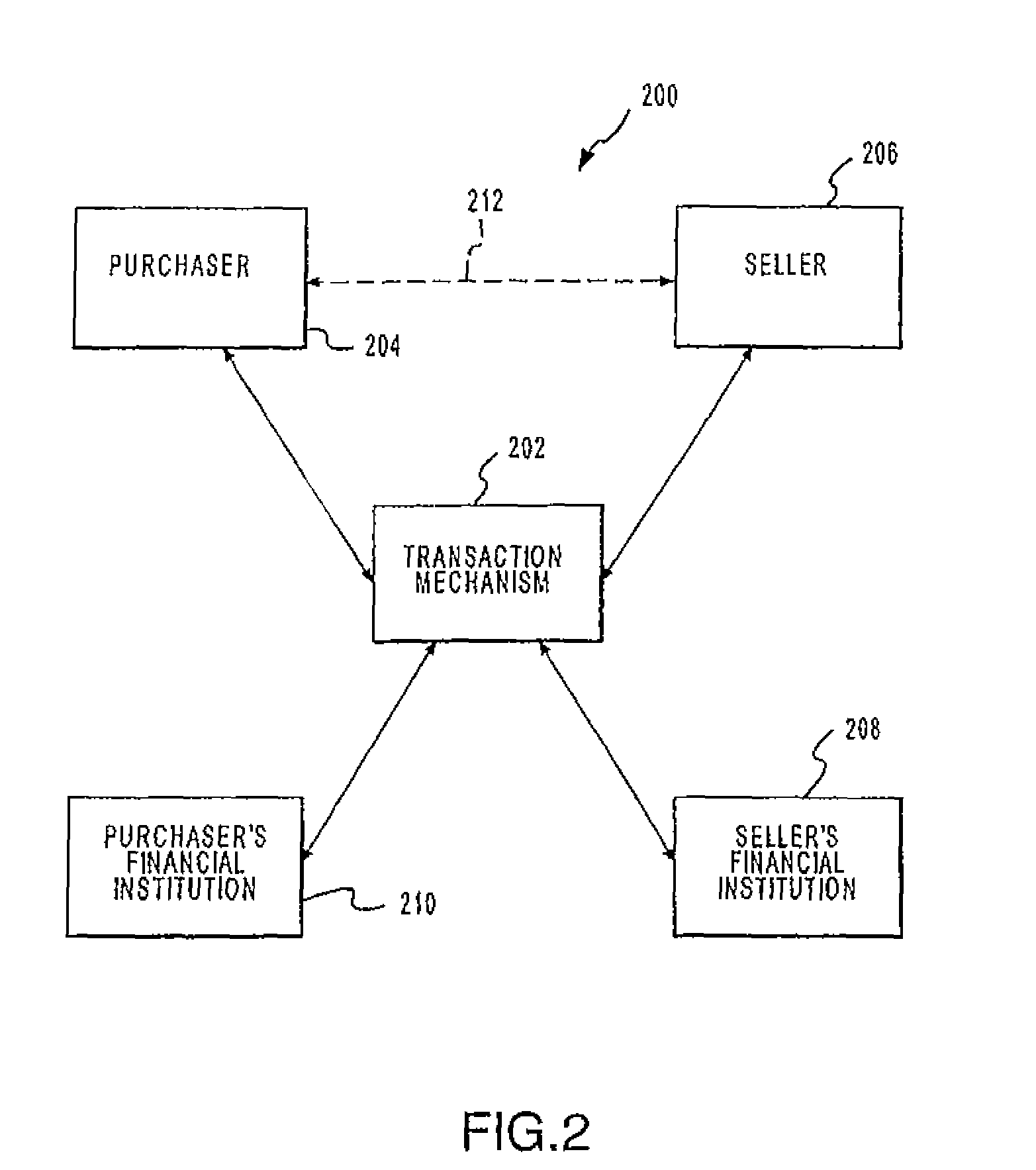

Methods and systems coordinate an Internet-based financial transaction between an Internet merchant and a customer. A first information packet is received with a payment network from the Internet merchant. The first information packet has a credential assigned to the customer and transaction information specifying at least a cost of the Internet-based financial transaction. With the payment network, account information is determined that identifies a financial account maintained by the customer at a financial institution and authorization information that allows debit access to the identified financial account. A second information packet that includes the transaction information, the account information, and the authorization information is generated with the payment network. The second information packet is transmitted with the payment network to the financial institution with a request to perform a debit transaction from the identified financial account for the specified cost of the Internet-based financial transaction.

Owner:FIRST DATA

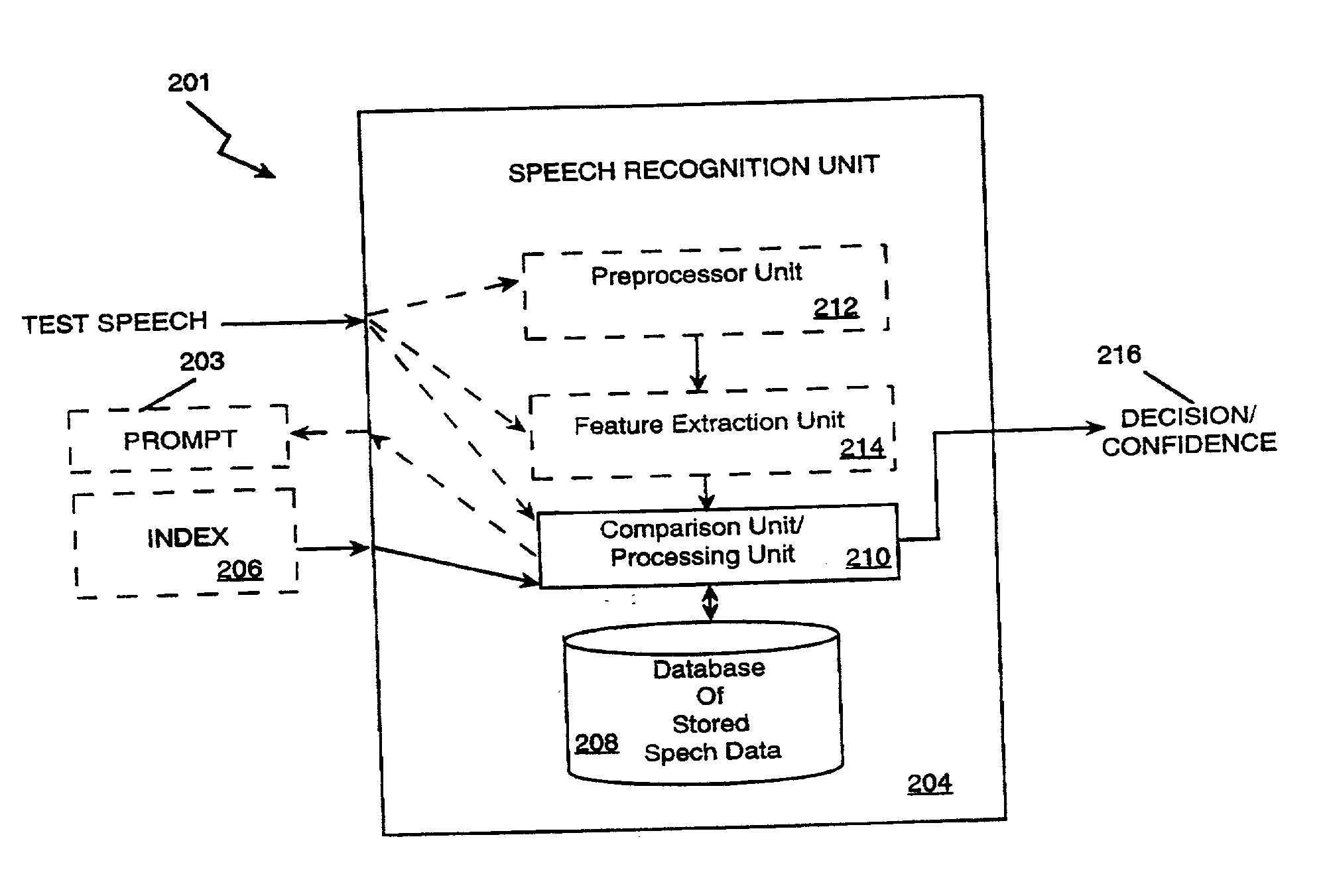

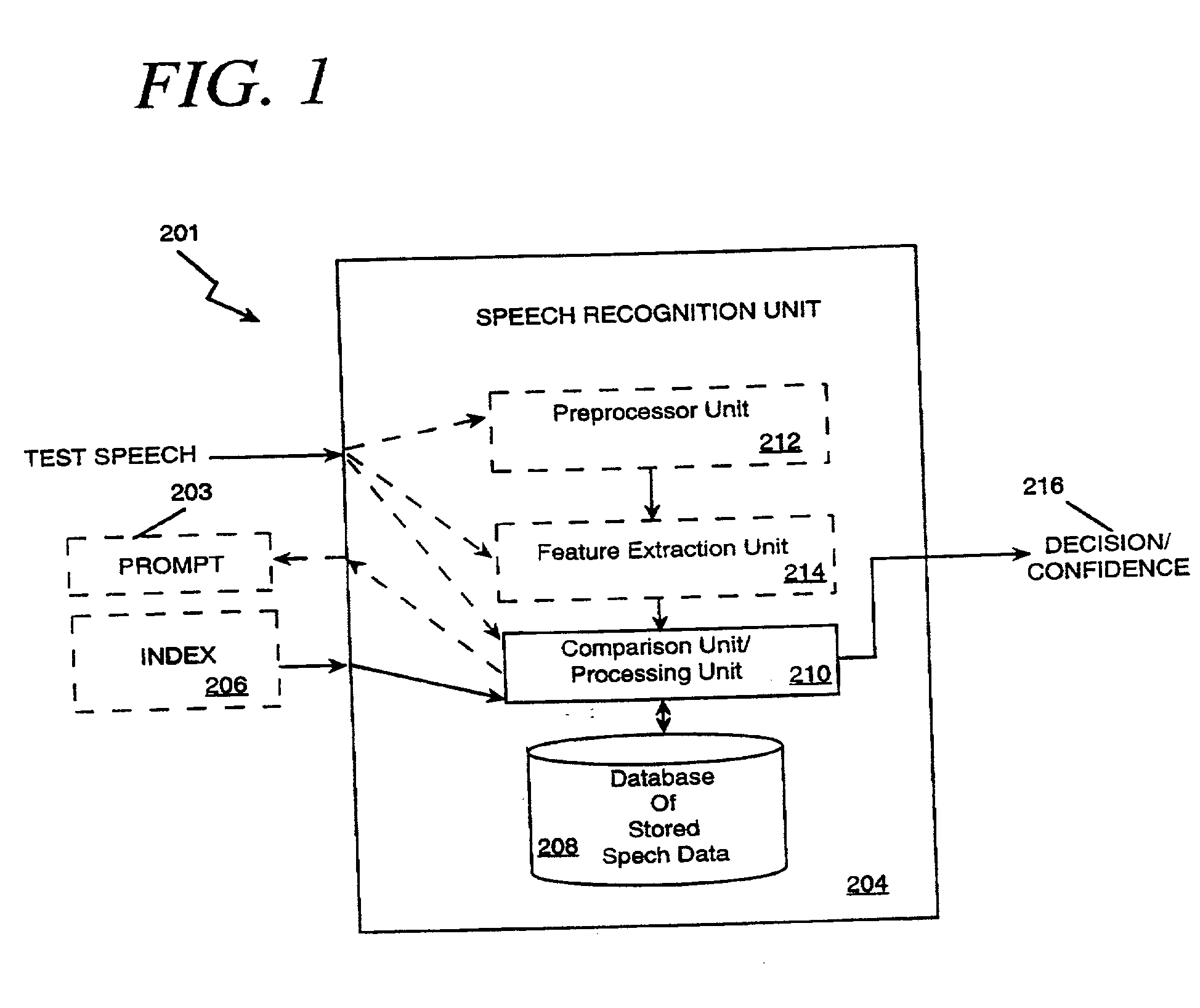

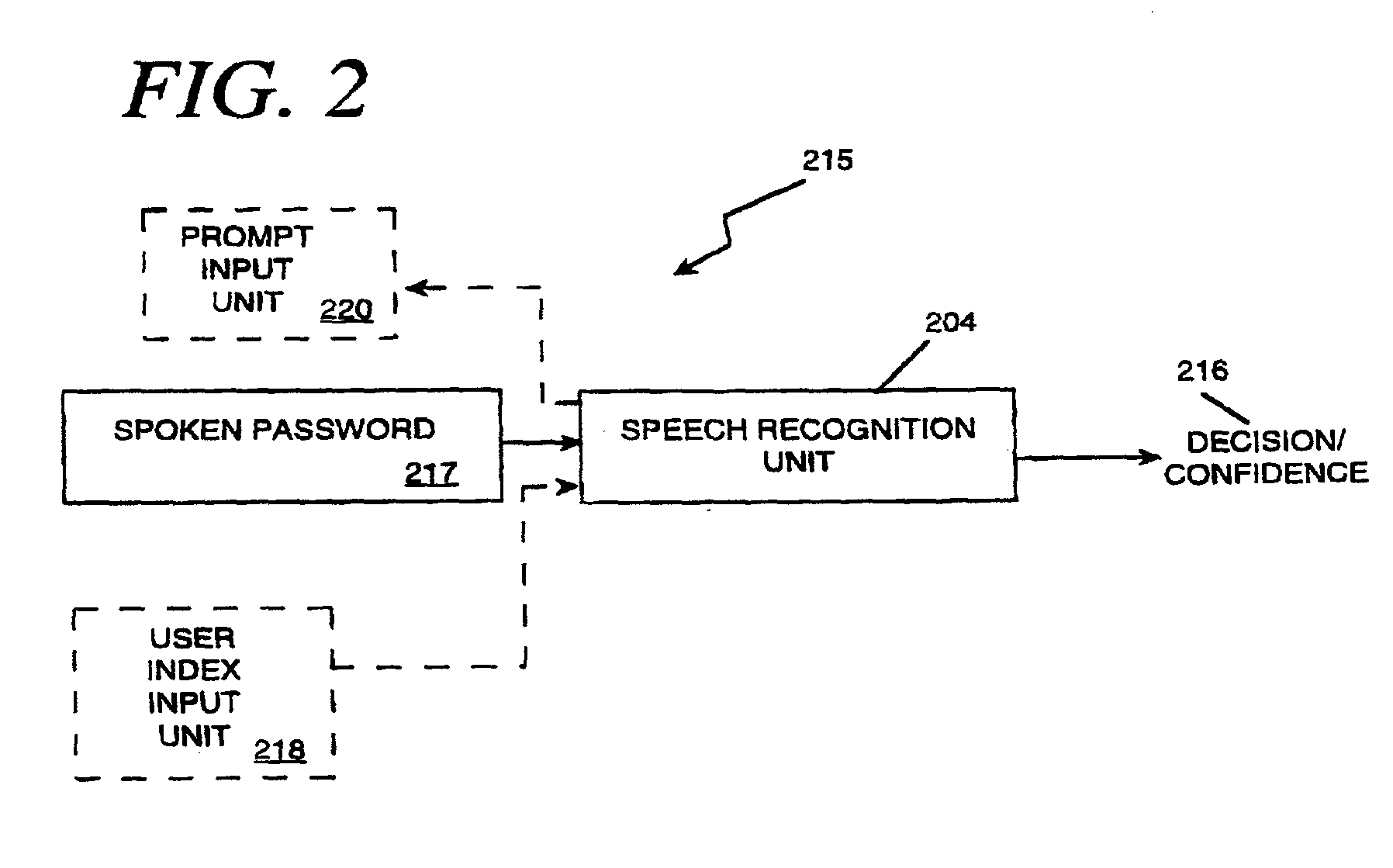

User validation for information system access and transaction processing

InactiveUS20030046083A1Robust methodPayment architectureDigital data authenticationUser verificationSpeech identification

The present invention applies speech recognition technology to remote access, verification, and identification applications. Speech recognition is used to raise the security level of many types of transaction systems which previously had serious safety drawbacks, including: point of sale systems, home authorization systems, systems for establishing a call to a called party (including prison telephone systems), internet access systems, web site access systems, systems for obtaining access to protected computer networks, systems for accessing a restricted hyperlink, desktop computer security systems, and systems for gaining access to a networked server. A general speech recognition system using communication is also presented. Further, different types of speech recognition methodologies are useful with the present invention, such as "simple" security methods and systems, multi-tiered security methods and systems, conditional multi-tiered security methods and systems, and randomly prompted voice token methods and systems.

Owner:BANK ONE COLORADO NA AS AGENT +1

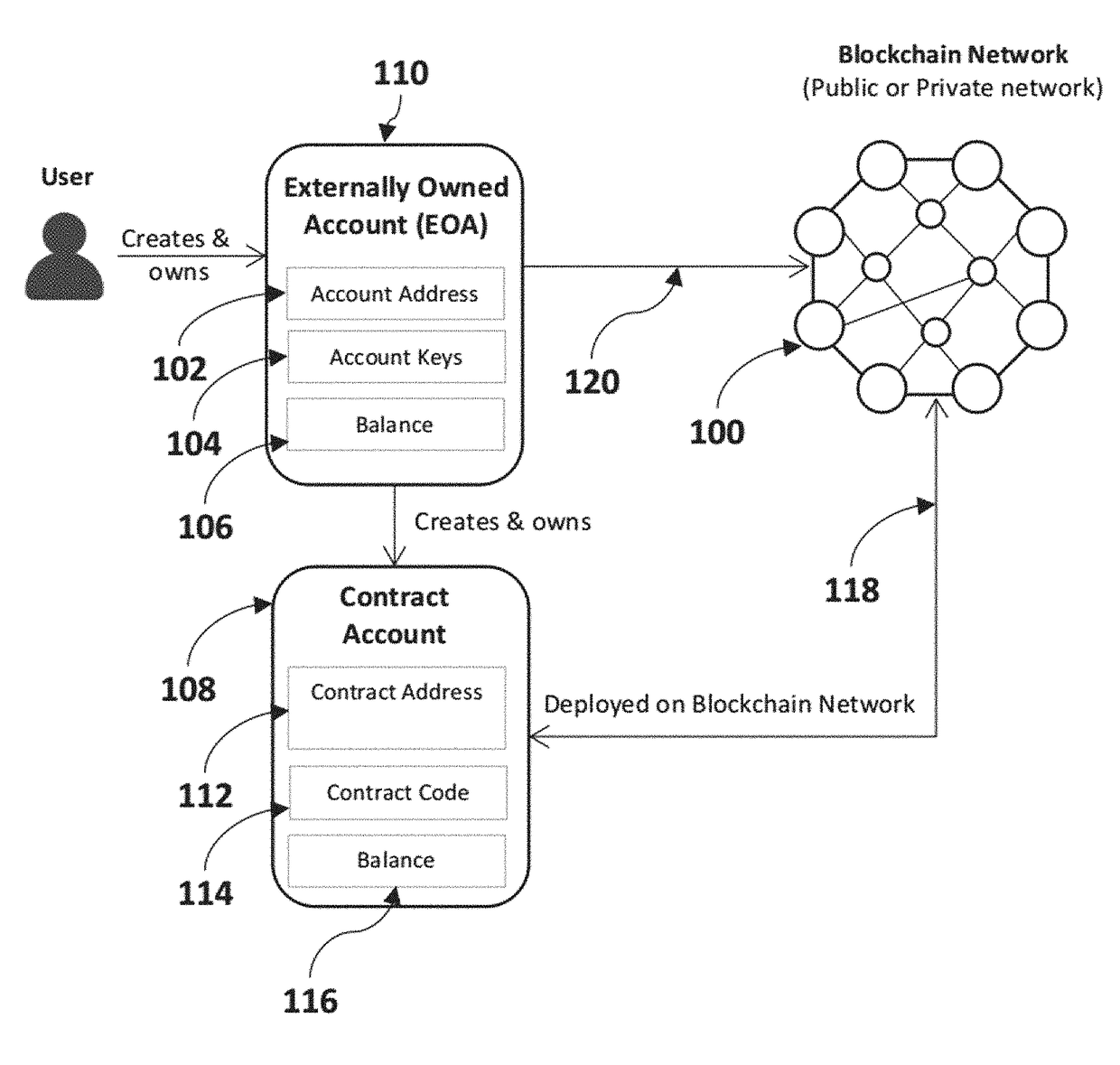

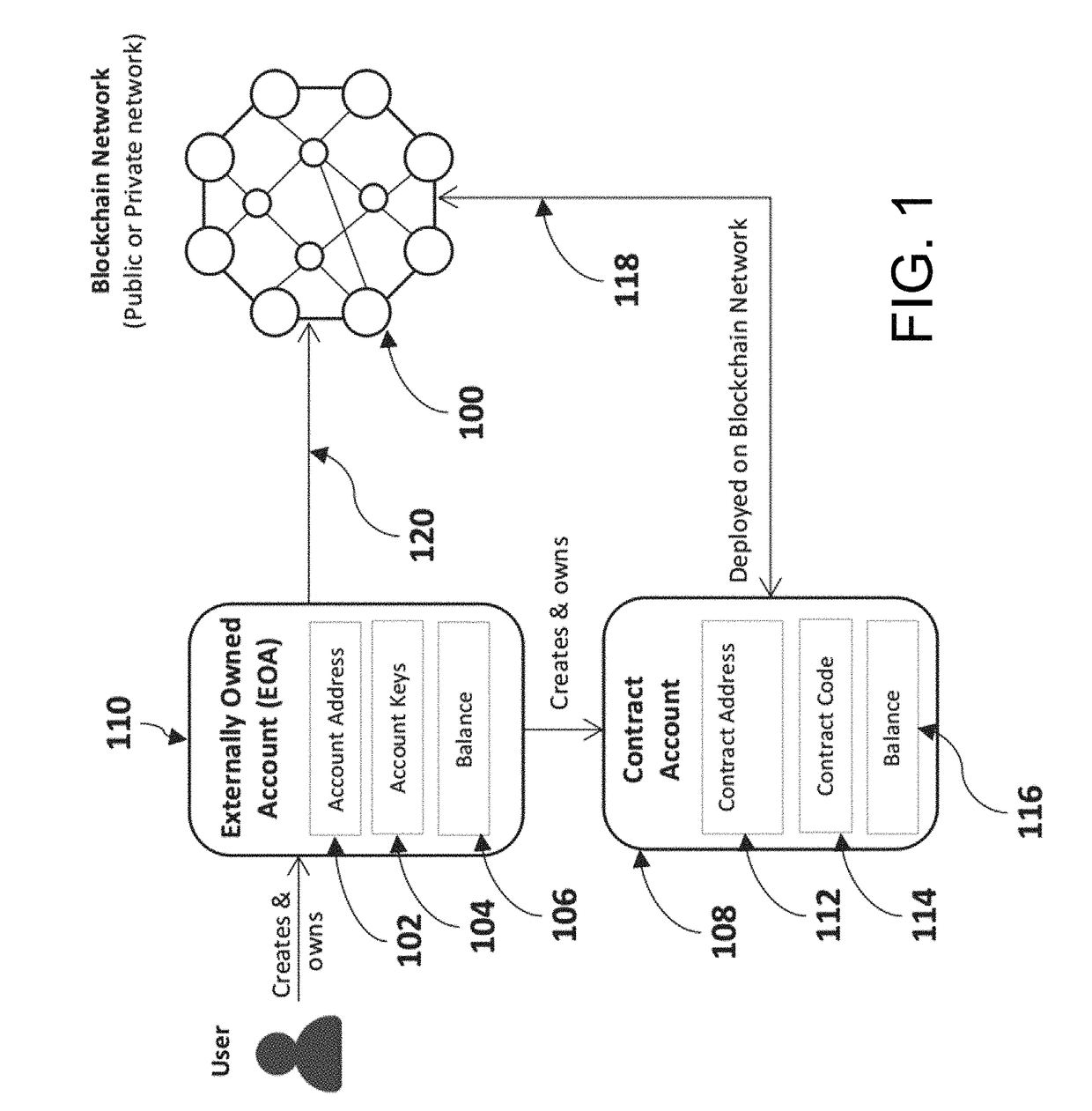

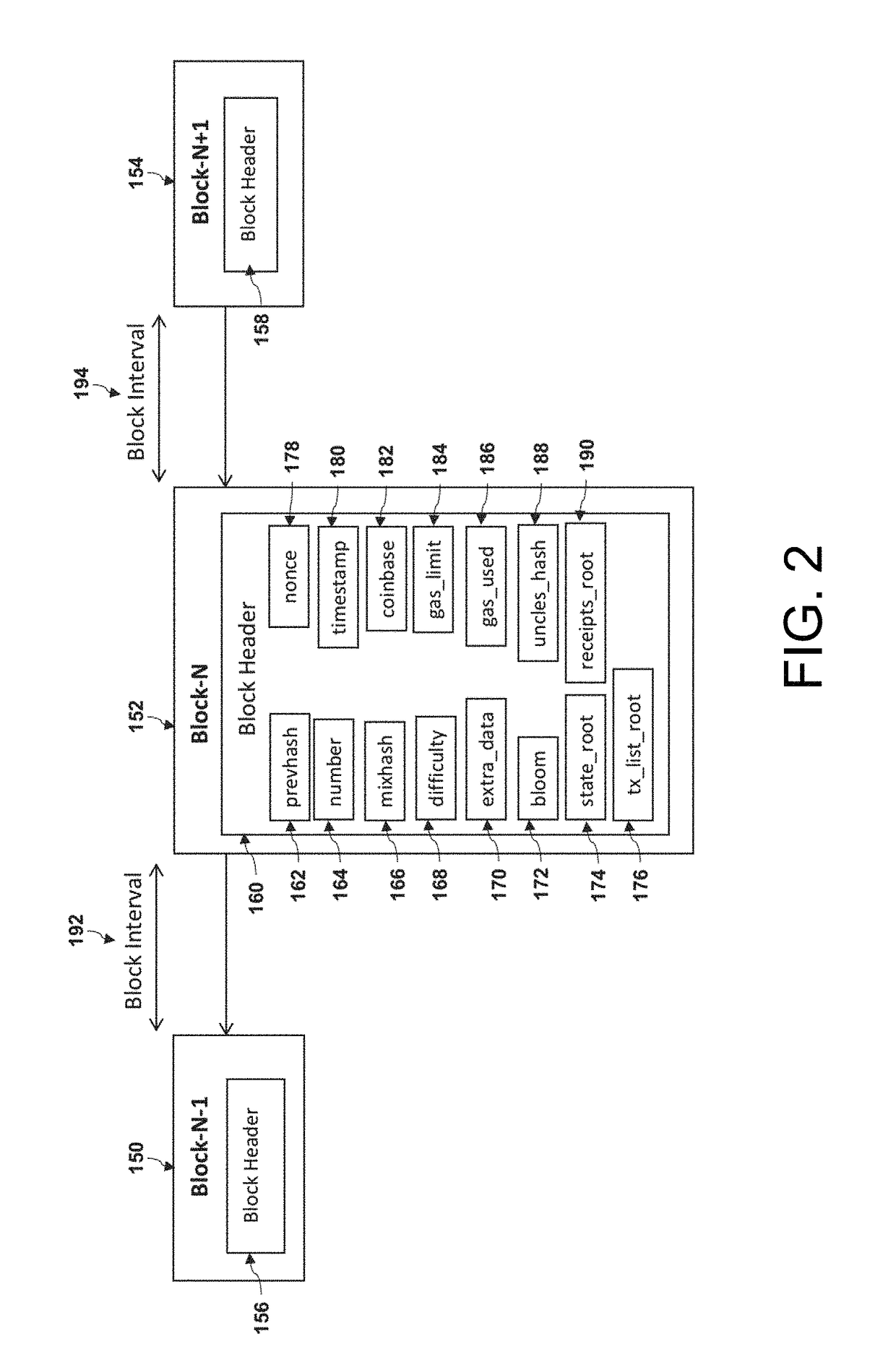

Method and system for tuning blockchain scalability for fast and low-cost payment and transaction processing

ActiveUS10102265B1Privacy protectionScalability issueEncryption apparatus with shift registers/memoriesCryptography processingPaymentSmart contract

A method of synchronizing transactions between blockchains comprising receiving first and second pluralities of transactions on a first private blockchain network and recording them to first and second private blocks on the first private blockchain network, respectively, generating a first merged block comprising the first private block and the second private block and recording the first merged block to a single block on a second blockchain network, recording each of the first and second private blocks and the first merged block to a first private smart contract linked to the first private blockchain network, performing a synchronization process between the first private smart contract and a second smart contract linked to the second blockchain network, defining a second smart contract, and performing a checkpointing process between the first private smart contract and the second smart contract. The first private blockchain network has a parameter difference from the second blockchain network.

Owner:MADISETTI VIJAY K

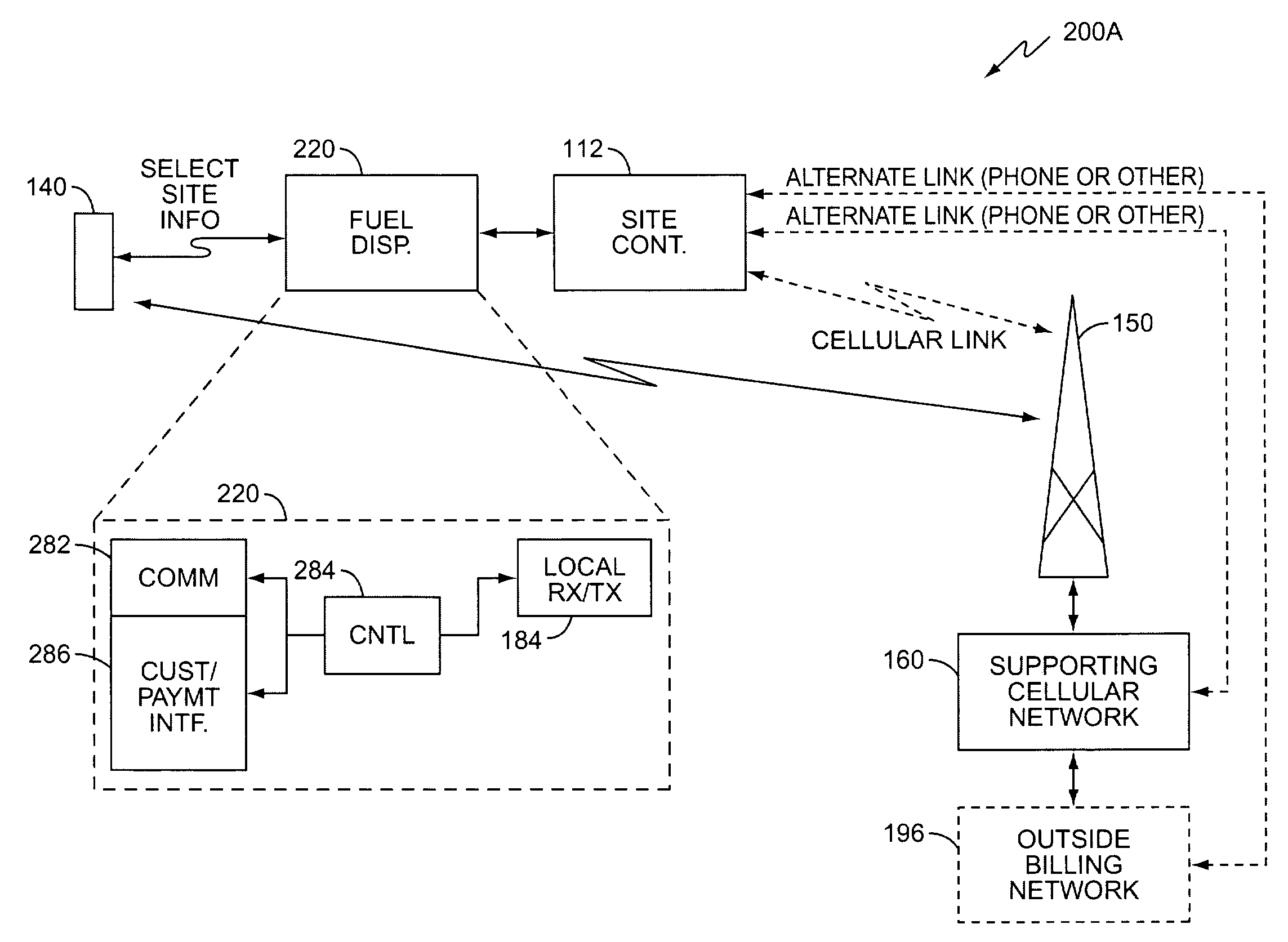

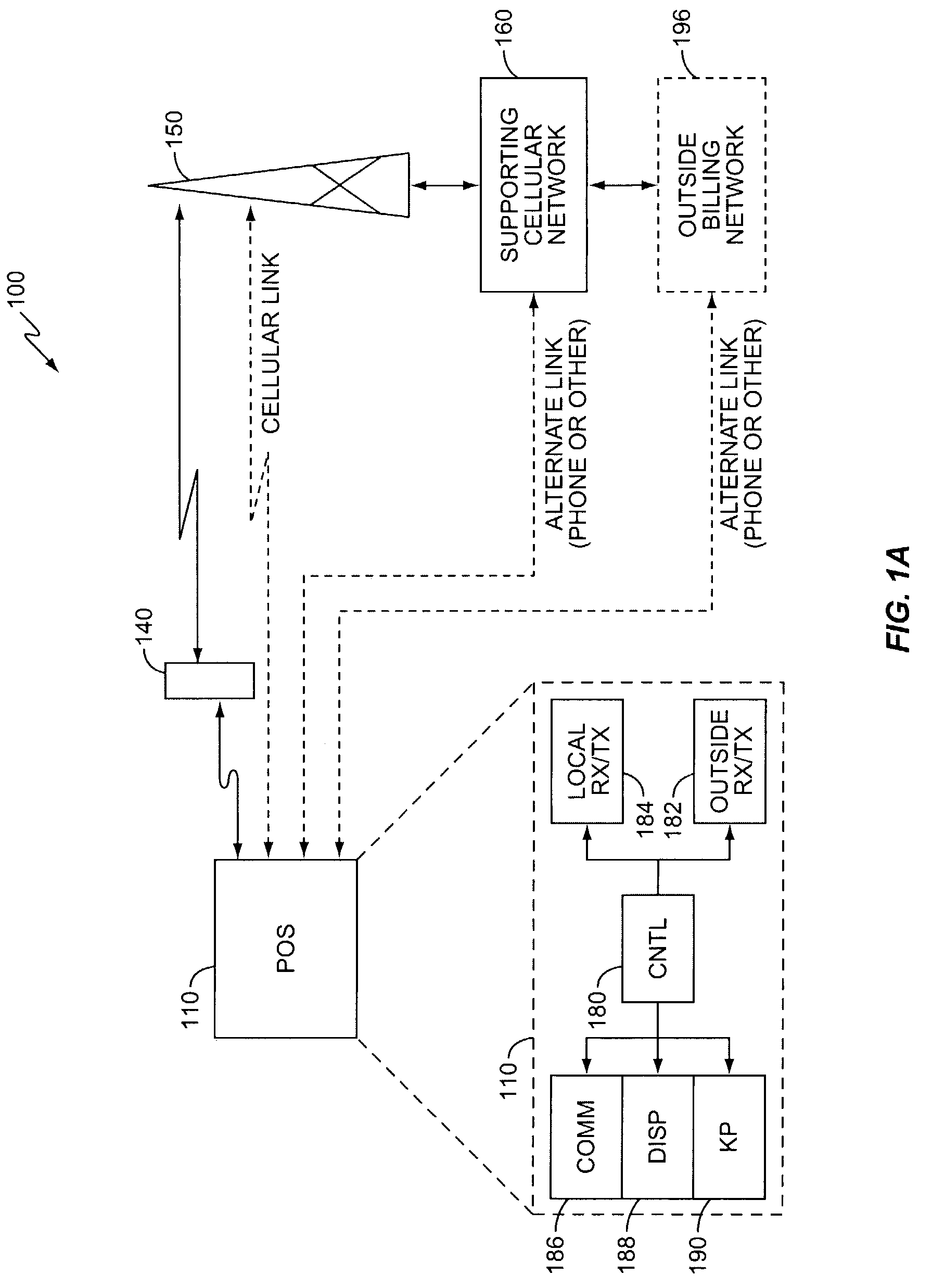

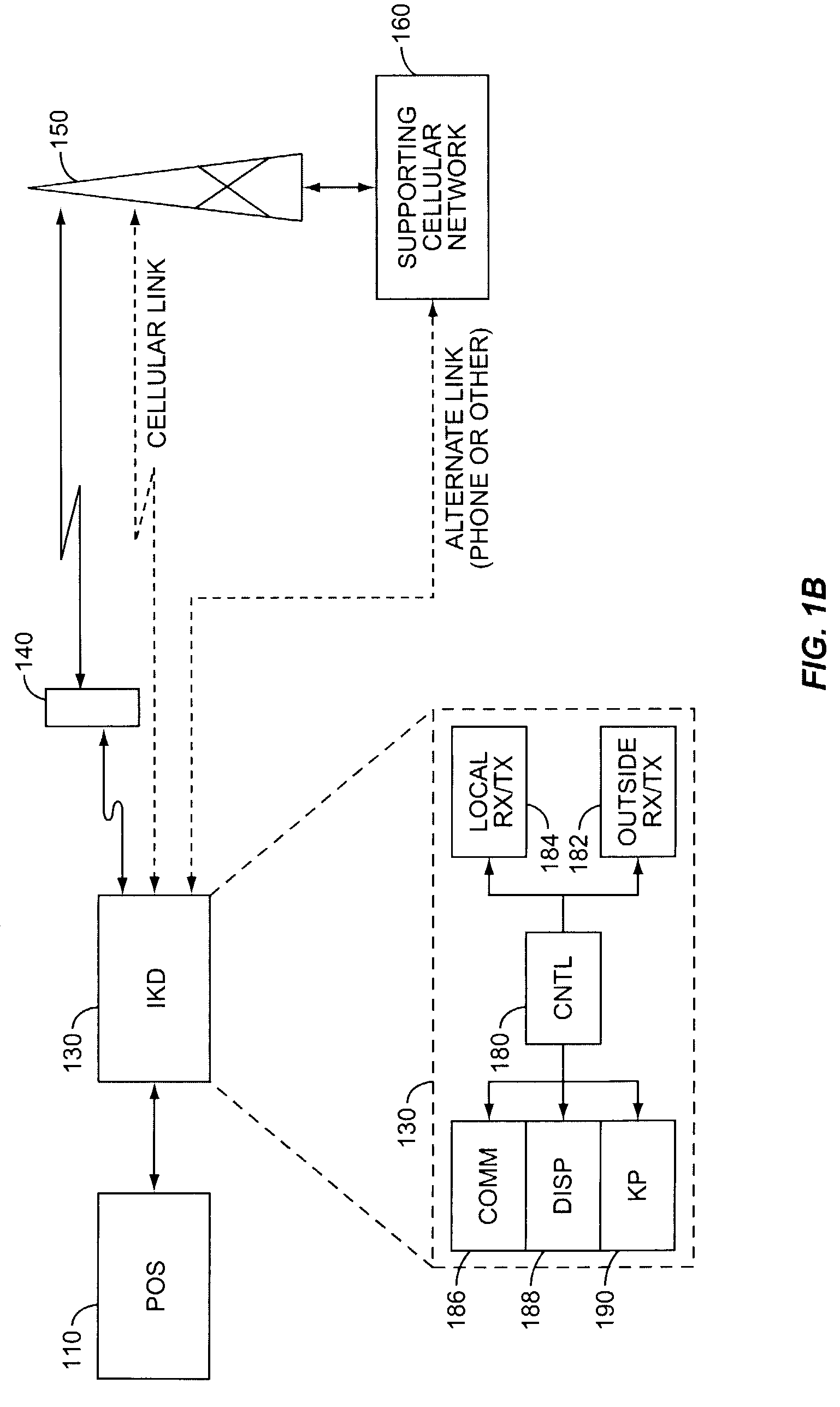

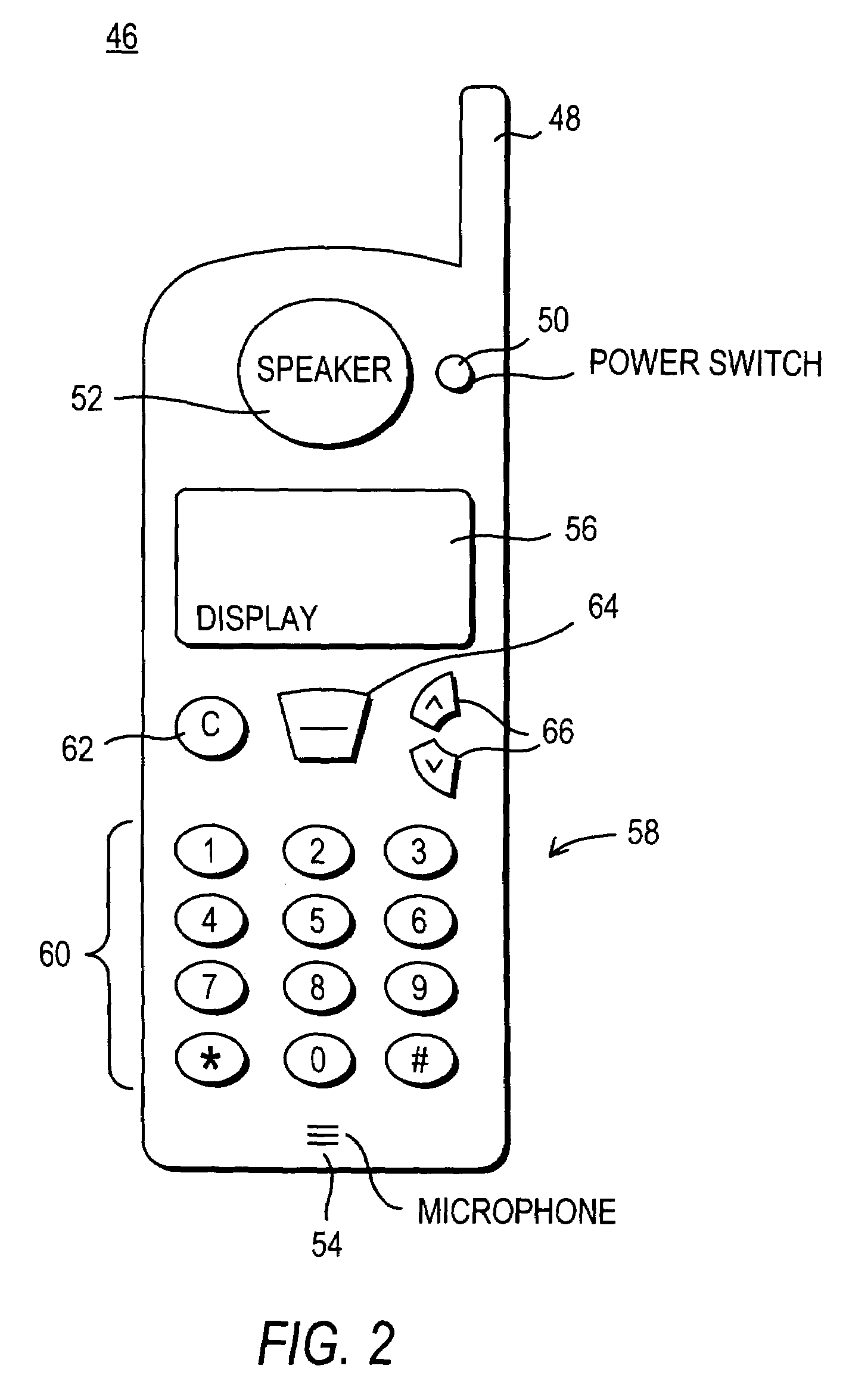

Cellular telephone-based transaction processing

InactiveUS7039389B2Telephonic communicationCredit schemesTelecommunications linkFinancial transaction

A retail transaction system provides enhanced customer convenience and increased transaction security by sending transaction information to a cellular network provider via a customer's digital cellular phone. For example, a fuel dispenser is equipped with a communications link allowing direct communications to a customer's cellular phone. When a customer desires to conduct a transaction using the fuel dispenser, the fuel dispenser transmits select information to the customer's cellular telephone using this communications link. A telephone number is included in the select information. When the customer presses send, or otherwise causes their telephone to dial the number transferred from the fuel dispenser, the select information along with any additional customer information is sent to the cellular network. This information is used by the network to authorize a purchase transaction for the customer, such authorization information returned to the fueling station at which the fuel dispenser is located via a cellular link. For enhanced security, the customer may be required to input their PIN in order to complete the transaction. Notably, the PIN and the remainder of the transaction information sent from the customer phone to the cellular network is intrinsically secure due to the digital encryption employed by the digital cellular protocol. Optionally, the system may be configured to cause the customer's cellular phone to automatically dial the number transferred by the fuel dispenser. This capability may be enabled at the customer's option. The system may be extended to other retail systems including in-store point-of-sale systems (POS).

Owner:GILBARCO

Financial transaction processing system and method

InactiveUS6302326B1Easy to develop and modifyEasy to changeComplete banking machinesHand manipulated computer devicesRelational databaseFinancial transaction

A financial transaction processing system (10) enables processing transactions from various types of card activated terminal devices (12) which communicate using a variety of electronic message formats. The transaction processing system includes among its software components message gateway routers (MGRs) (24, 164) which operate using information stored in the relational database to convert messages from a variety of external message formats used by the external devices and authorization systems, to a common internal message format used within the system. The system further uses database information to internally route messages to message processing programs (MPPs) (108, 138) which process messages and generate messages to the external devices and authorization systems. The MGR also converts the outgoing messages from the internal message format to the external message formats which can be interpreted by the external devices and systems to which the messages are directed.

Owner:DIEBOLD NIXDORF

Cellular telephone interactive wagering system

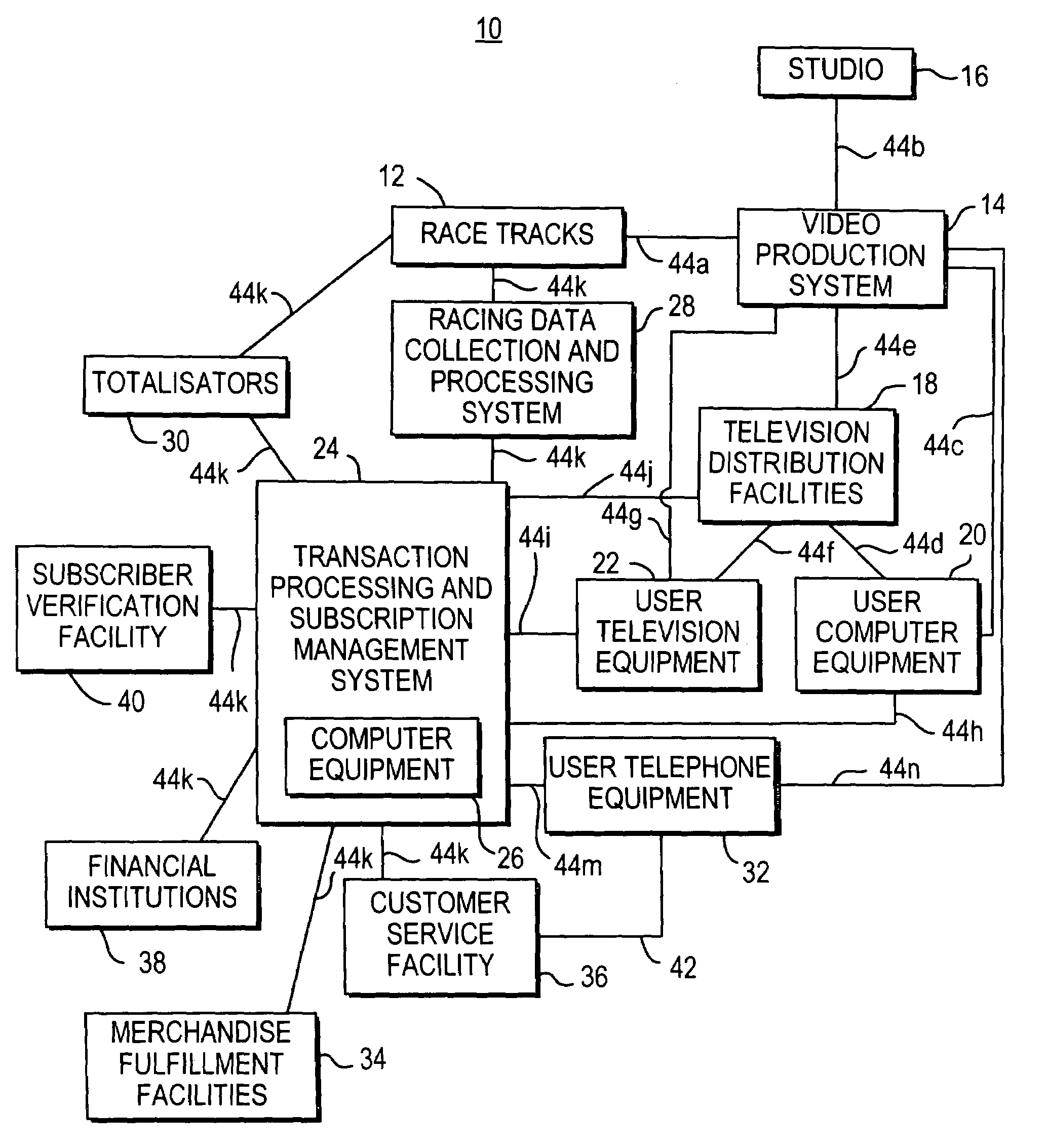

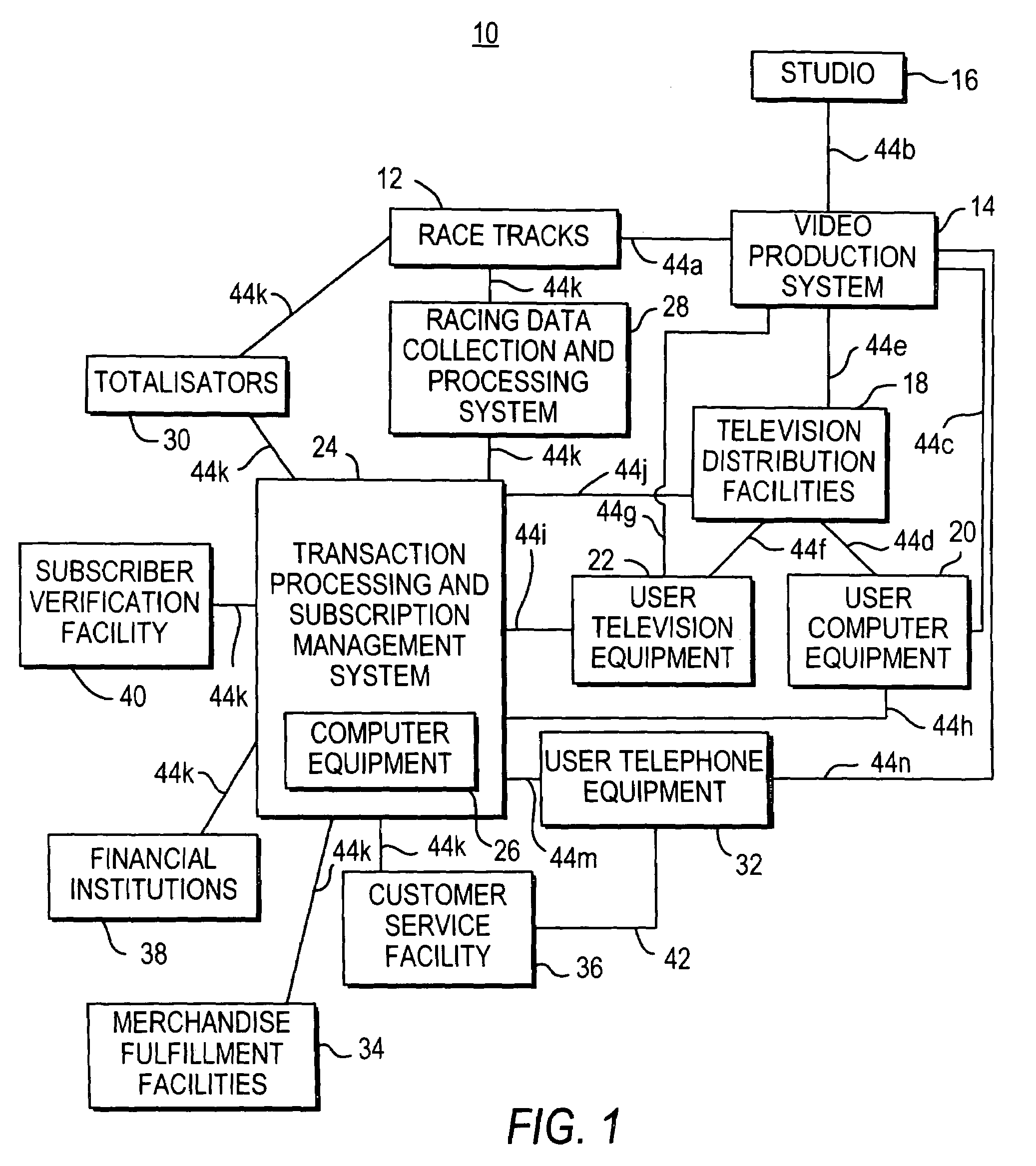

InactiveUS7379886B1Easy to set upReservationsRecombinant DNA-technologyTelevision equipmentTransaction processing system

Systems and processes for interactive wagering are provided. A cellular telephone or handheld computing device may be used to access an interactive wagering service. Television equipment and computer equipment may be used to access the service. A user may view information on wagers such as current odds and other racing data for horses or other runners on the cellular telephone or other device. The user may create a corresponding off-track wager with the cellular telephone or other device that may be sent to a transaction processing and subscription management system. The transaction processing and subscription management system may handle the wager transaction and adjust the user's account balance.

Owner:ODS PROPERTIES

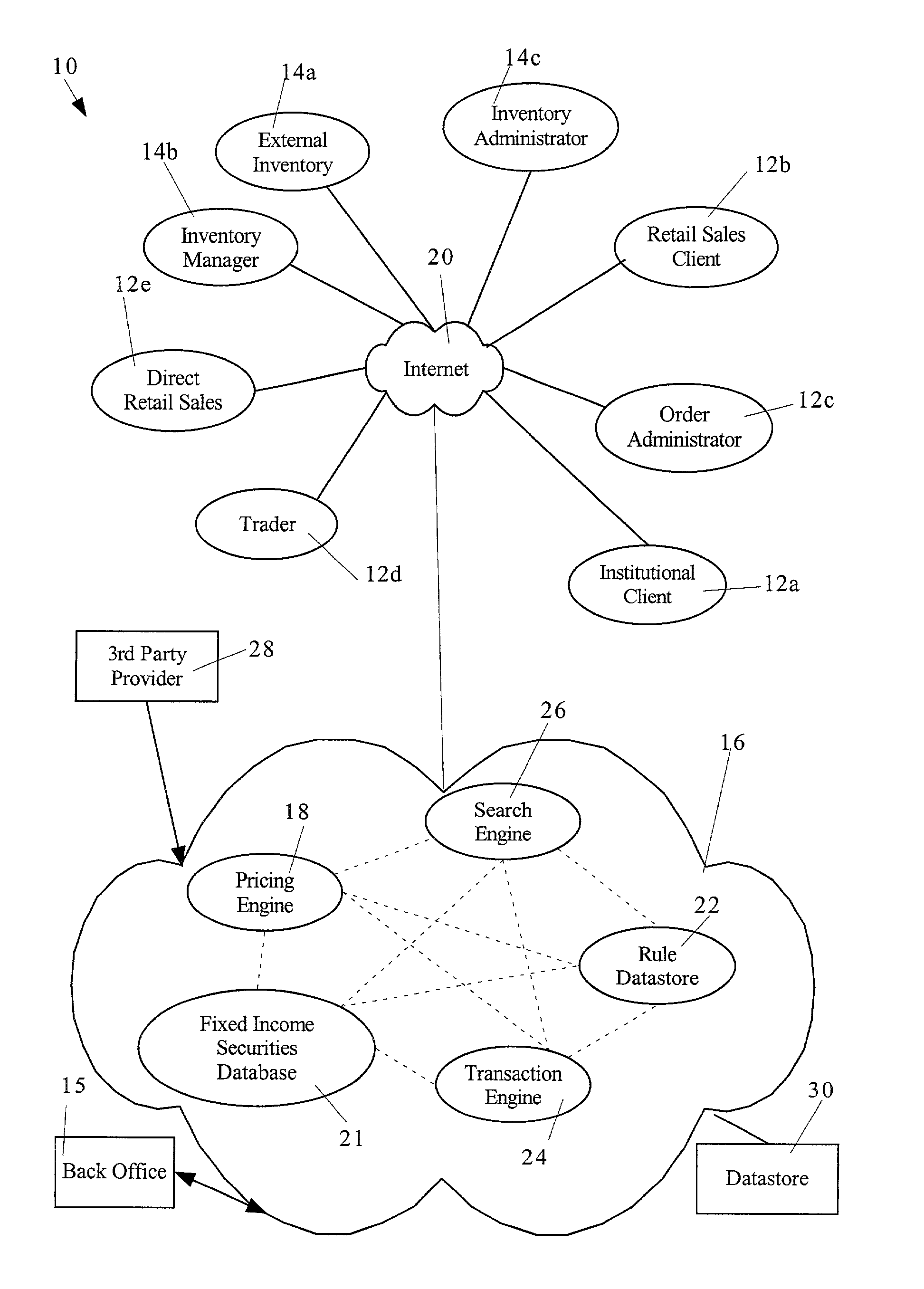

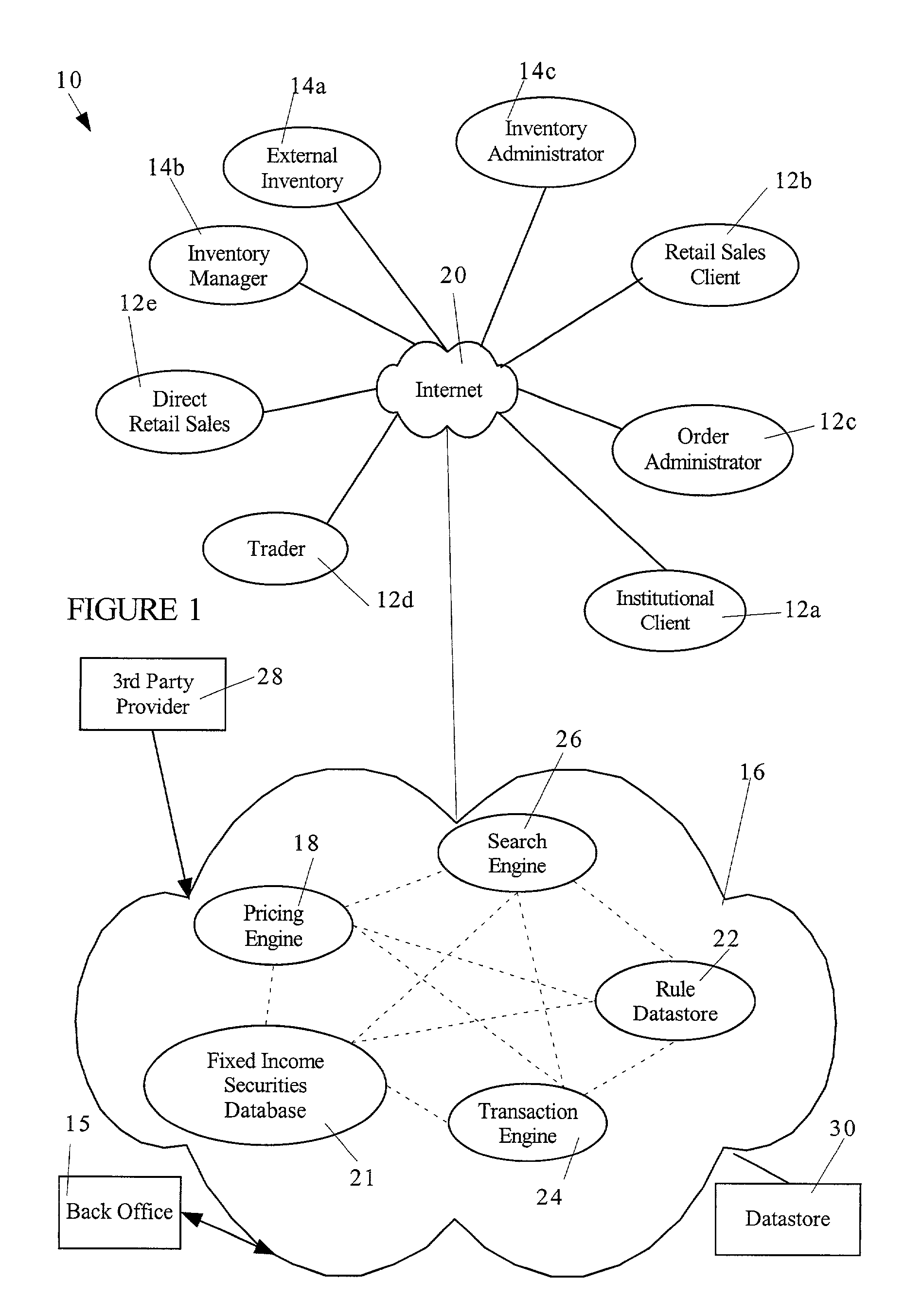

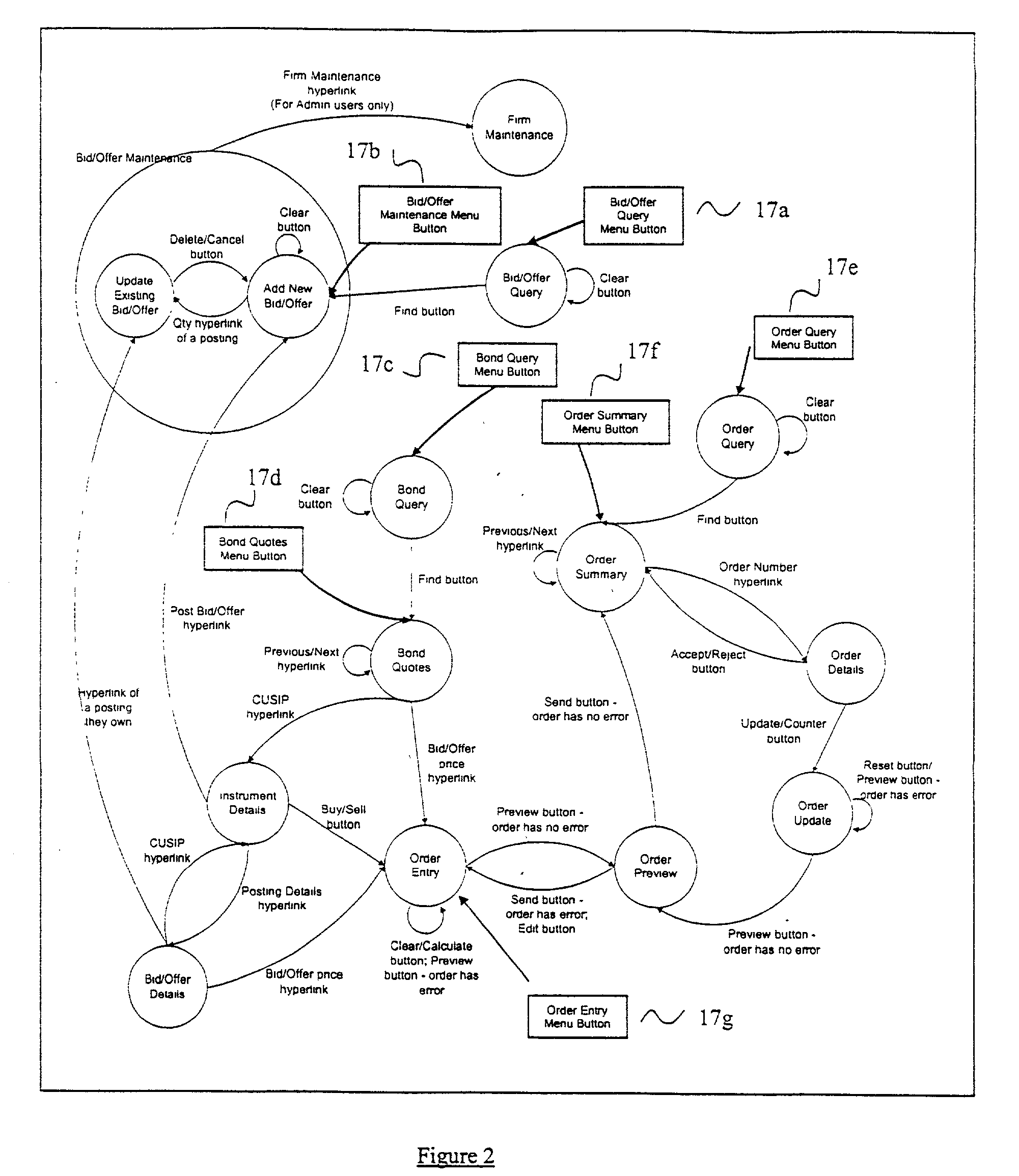

System and method for exchange and transaction processing for fixed income securities trading

InactiveUS20030233307A1Reduce in quantitySpecial service provision for substationFinanceTransaction processing systemData store

A fixed income securities trading framework for facilitating the negotiation and exchange of fixed income securities over an open network between a plurality of participants wherein, the trading framework comprises: a bond network having a search engine, a rule datastore, a pricing engine, a transaction engine and a fixed income securities database comprised a plurality of bids and offers; a pair of participants where at least one participant is a liquidity provider; and a datastore; wherein at least one of the search engine and the transaction engine correlates criteria defined by one of the participants to the bond database as requested by the participant and where at least one of the search engine and the transaction engine interact with the rules datastore on each of the participant request within the bond network; and wherein the bond network enables the participants to transact against one of a bid or offer posted in the fixed income securities database so as to facilitiate the exchange of fixed income securities between the participants.

Owner:SANCHEZ COMP ASSOC INC

Push Payment Processor

InactiveUS20140081783A1Hand manipulated computer devicesPoint-of-sale network systemsTransaction processing systemAuthorization

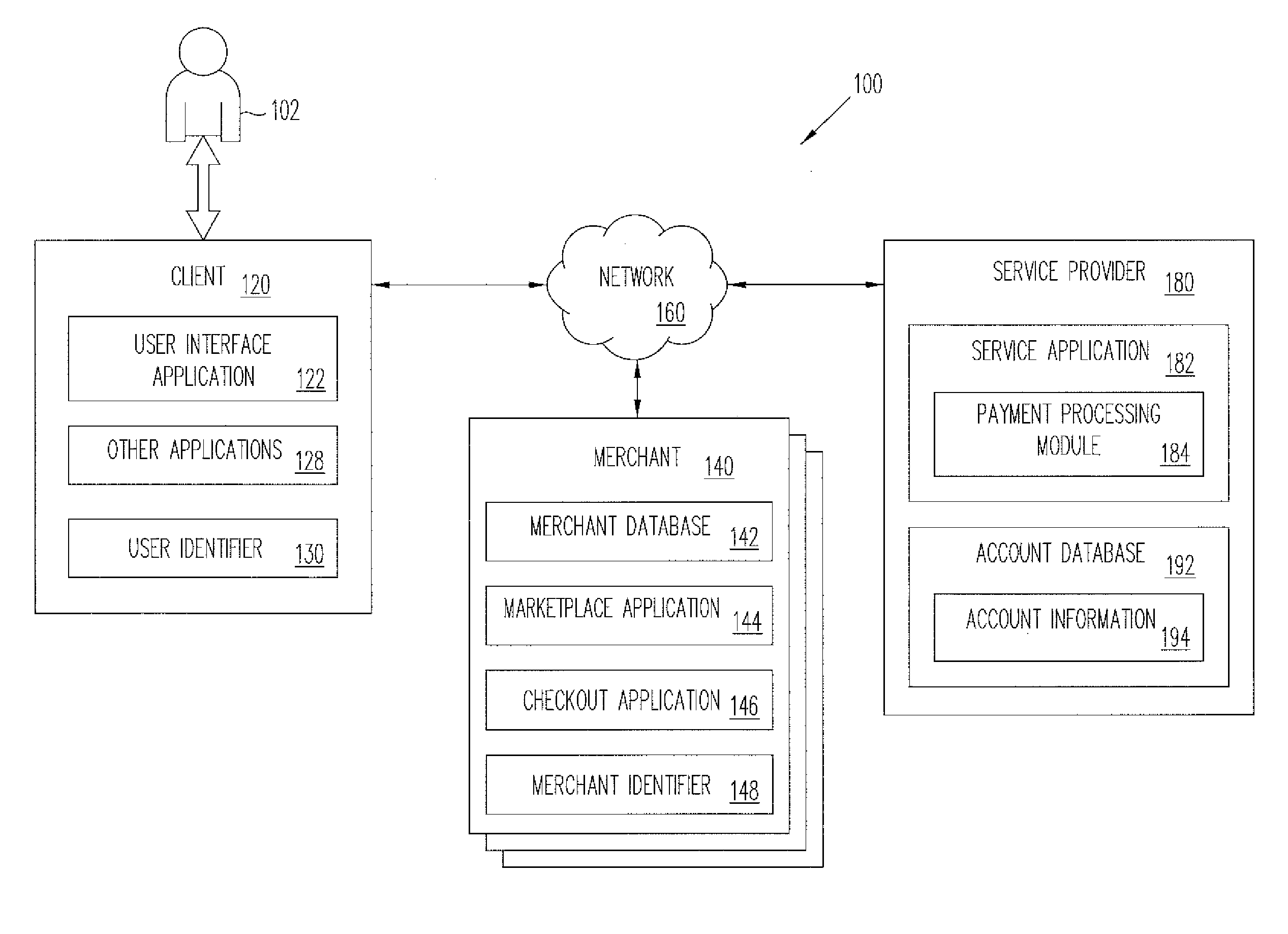

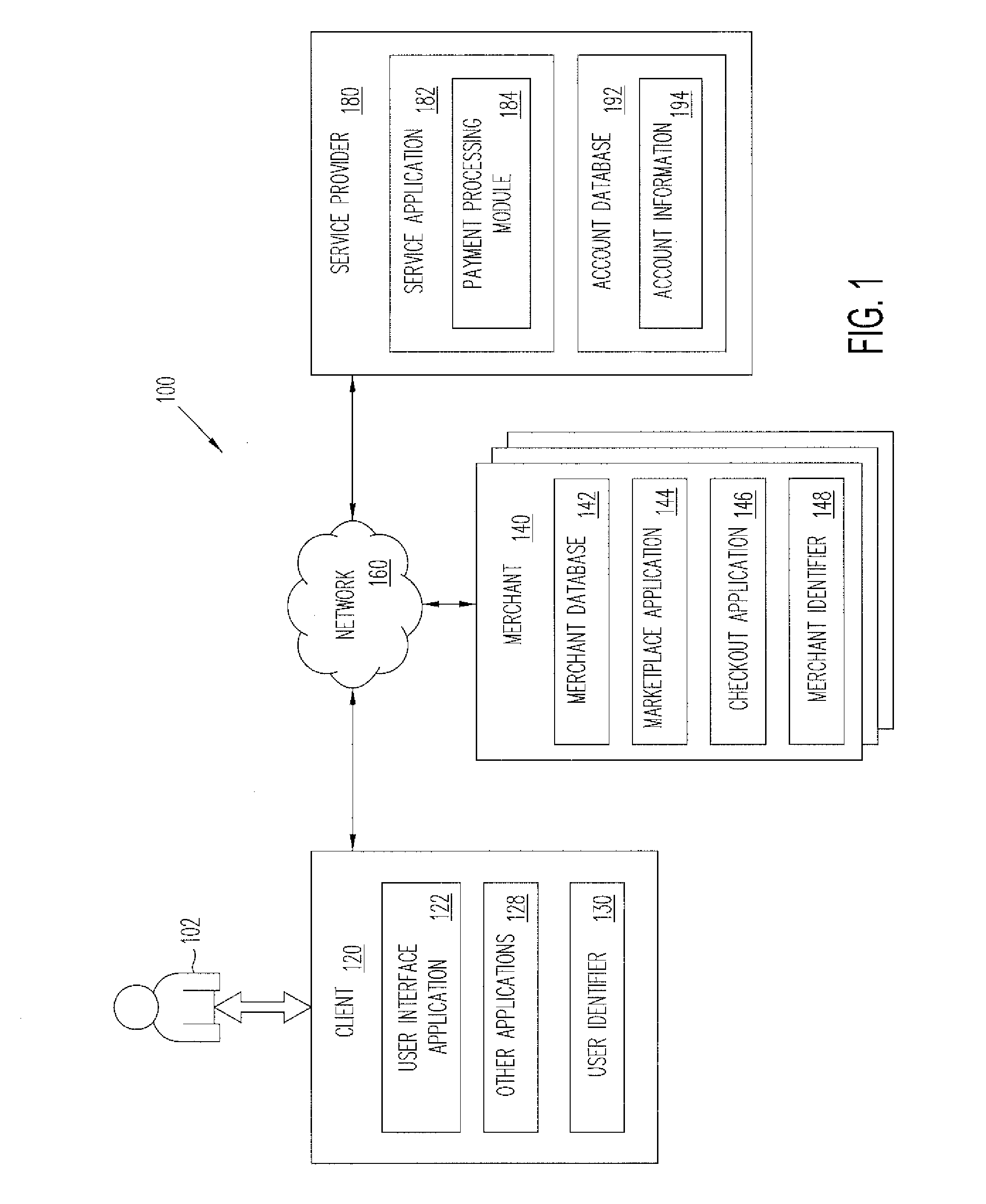

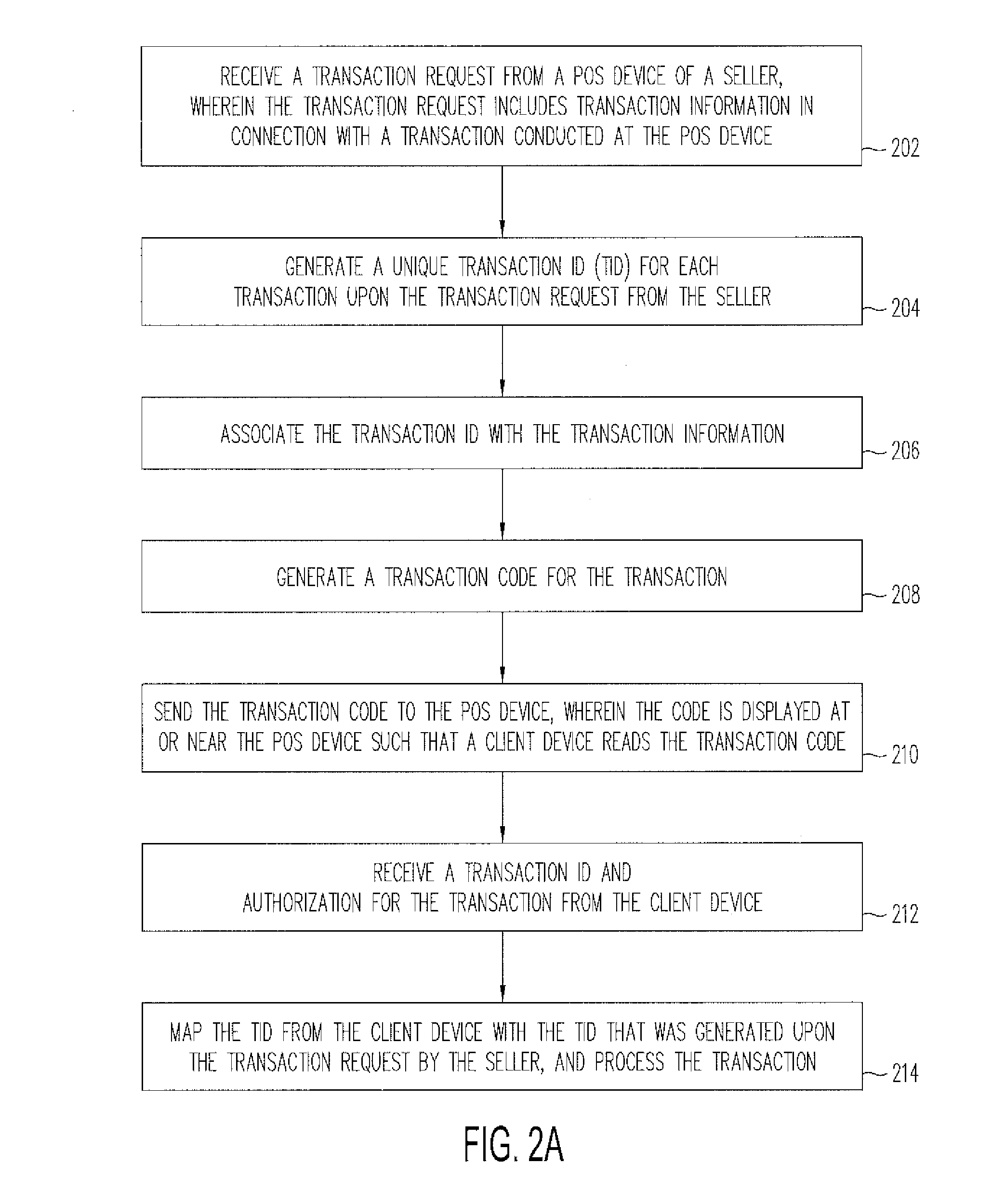

Embodiments of methods and systems provide transaction processing with dynamic generated codes. In an embodiment, a system comprises a remote server adapted to interact with a POS device and a client device; one or more processors; and one or more memories adapted to store machine-readable instructions to cause the system to: receive, by the server at the remote location, a transaction request from the POS device of the seller, wherein the transaction request includes transaction information in connection with a transaction conducted at the POS device; generate a transaction code upon receiving the transaction request from the POS device, wherein the transaction code includes the transaction information; send the transaction code to the POS device; receive an authorization request for the transaction from the client device after the client device reads the transaction code from the POS device; and process the transaction.

Owner:PAYPAL INC

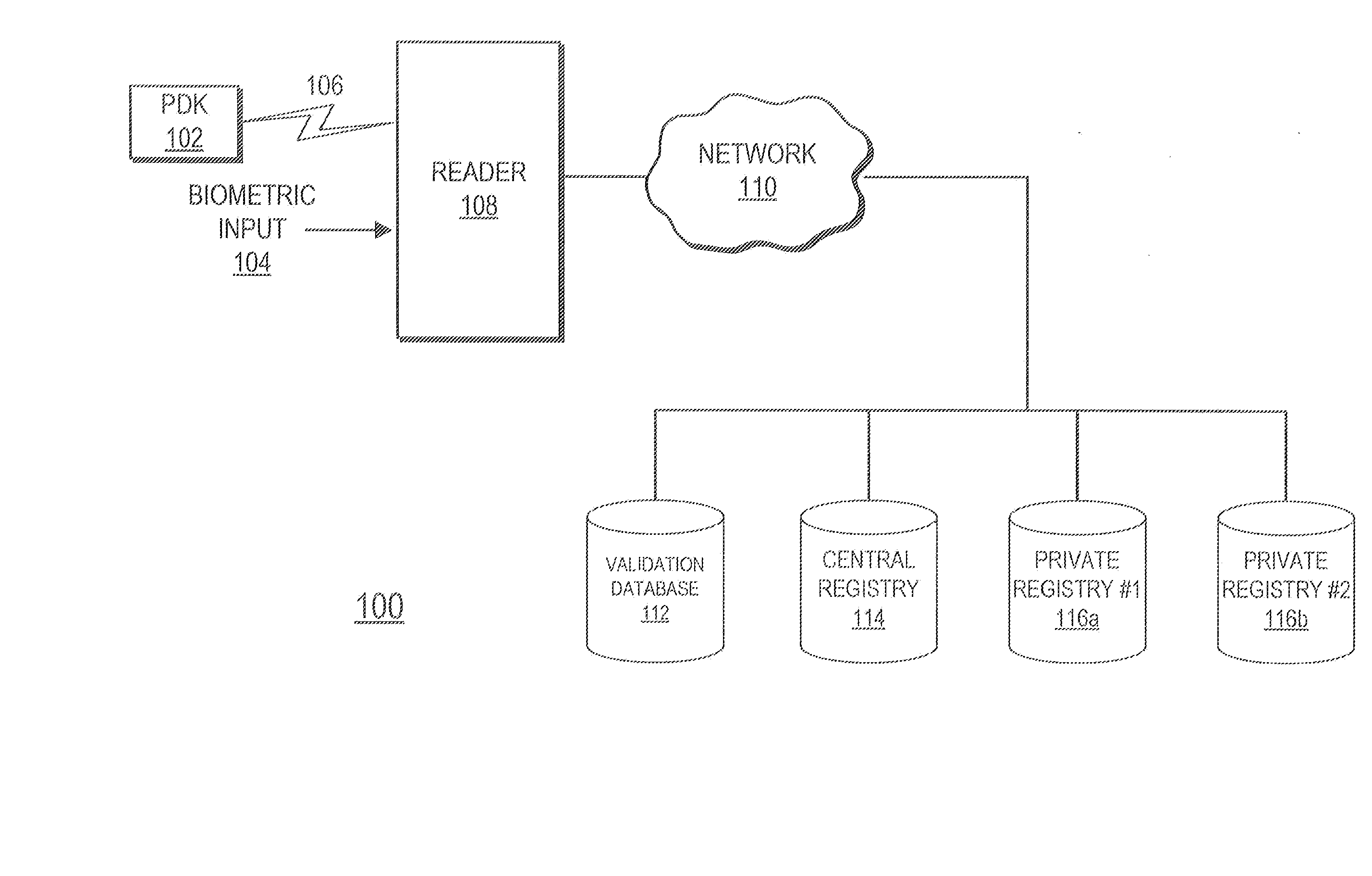

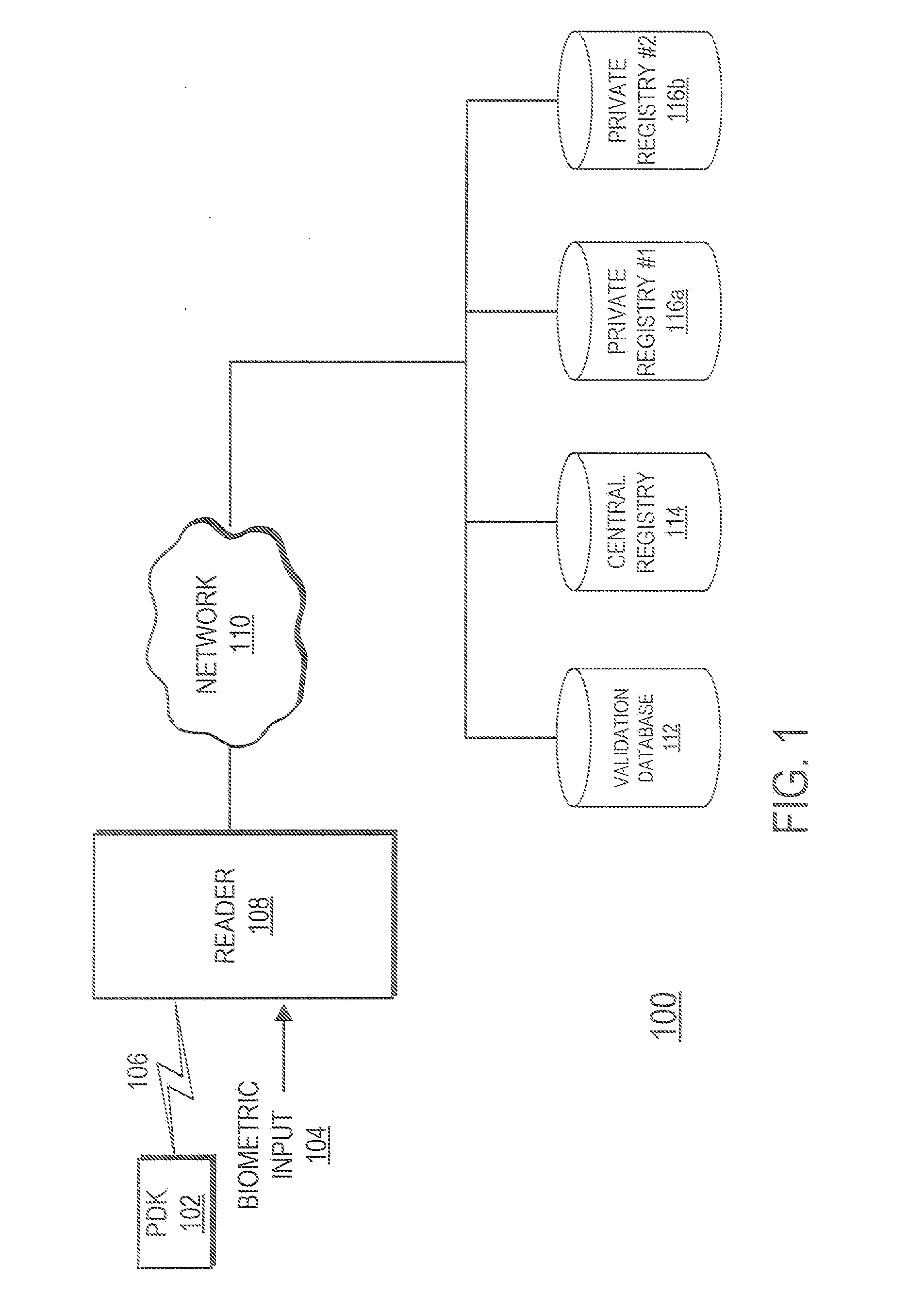

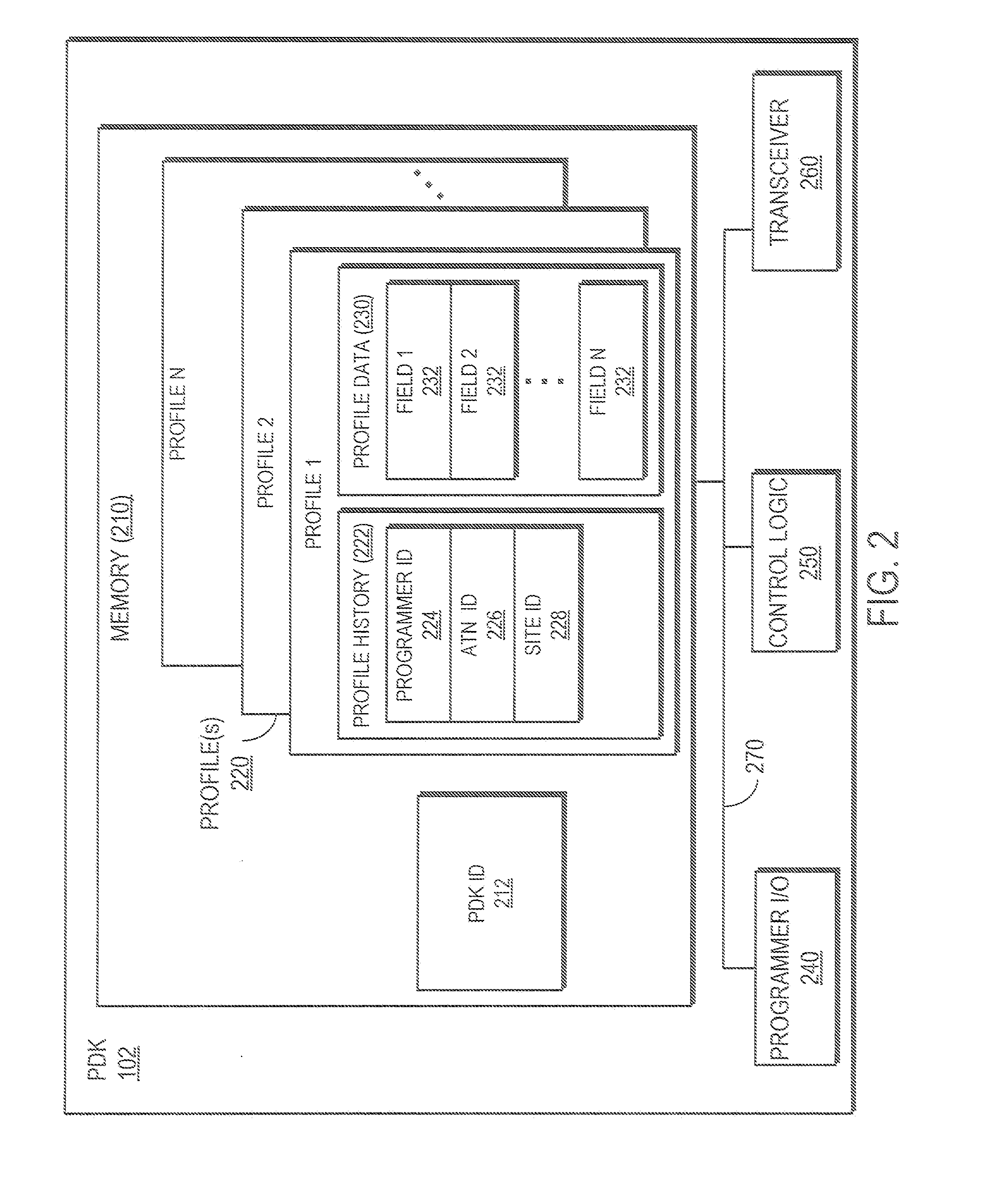

Personal digital key differentiation for secure transactions

ActiveUS20070260883A1Efficient and secure and highly reliable authenticationCompared quicklyAcutation objectsUser identity/authority verificationTamper resistanceTemporal information

Owner:PROXENSE

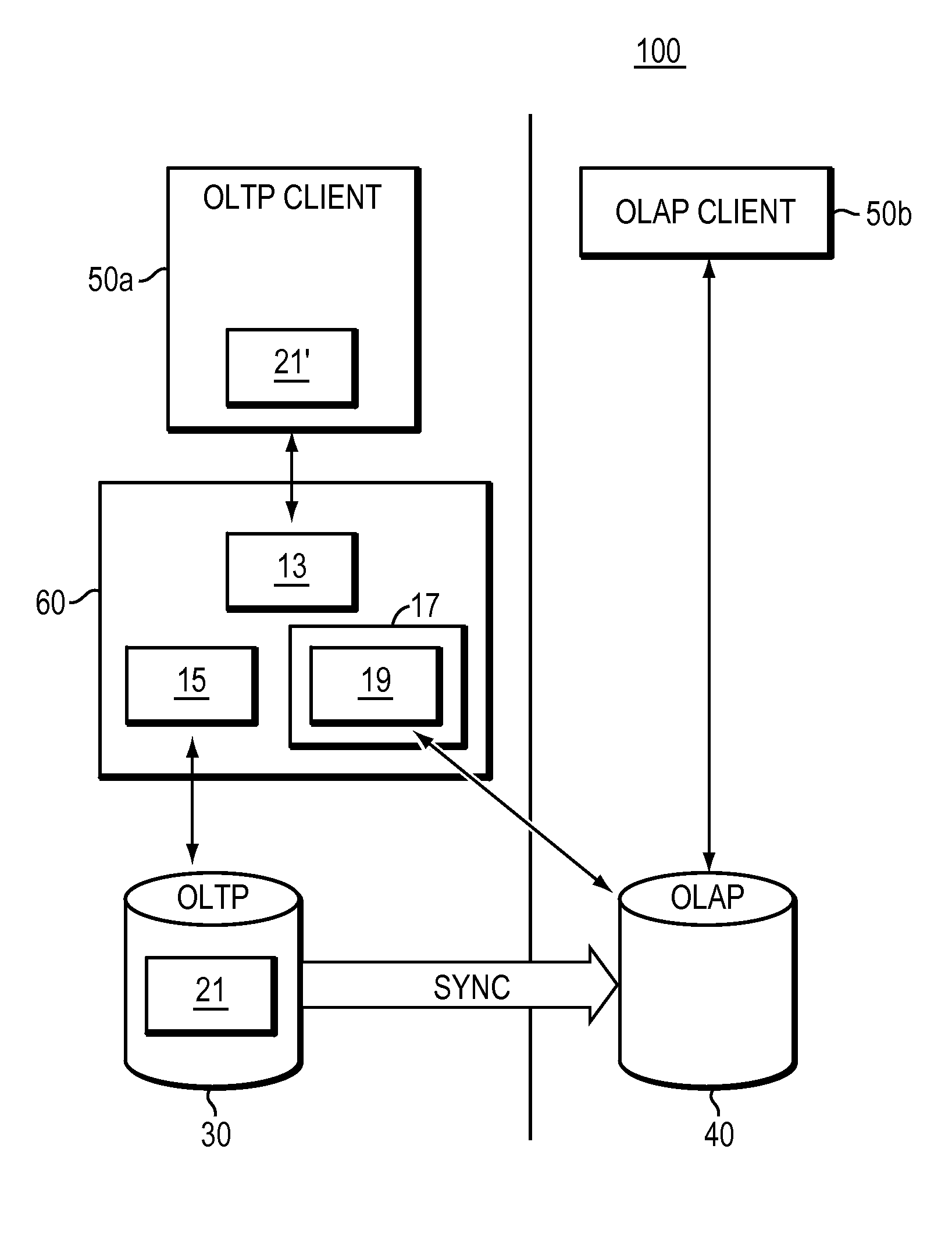

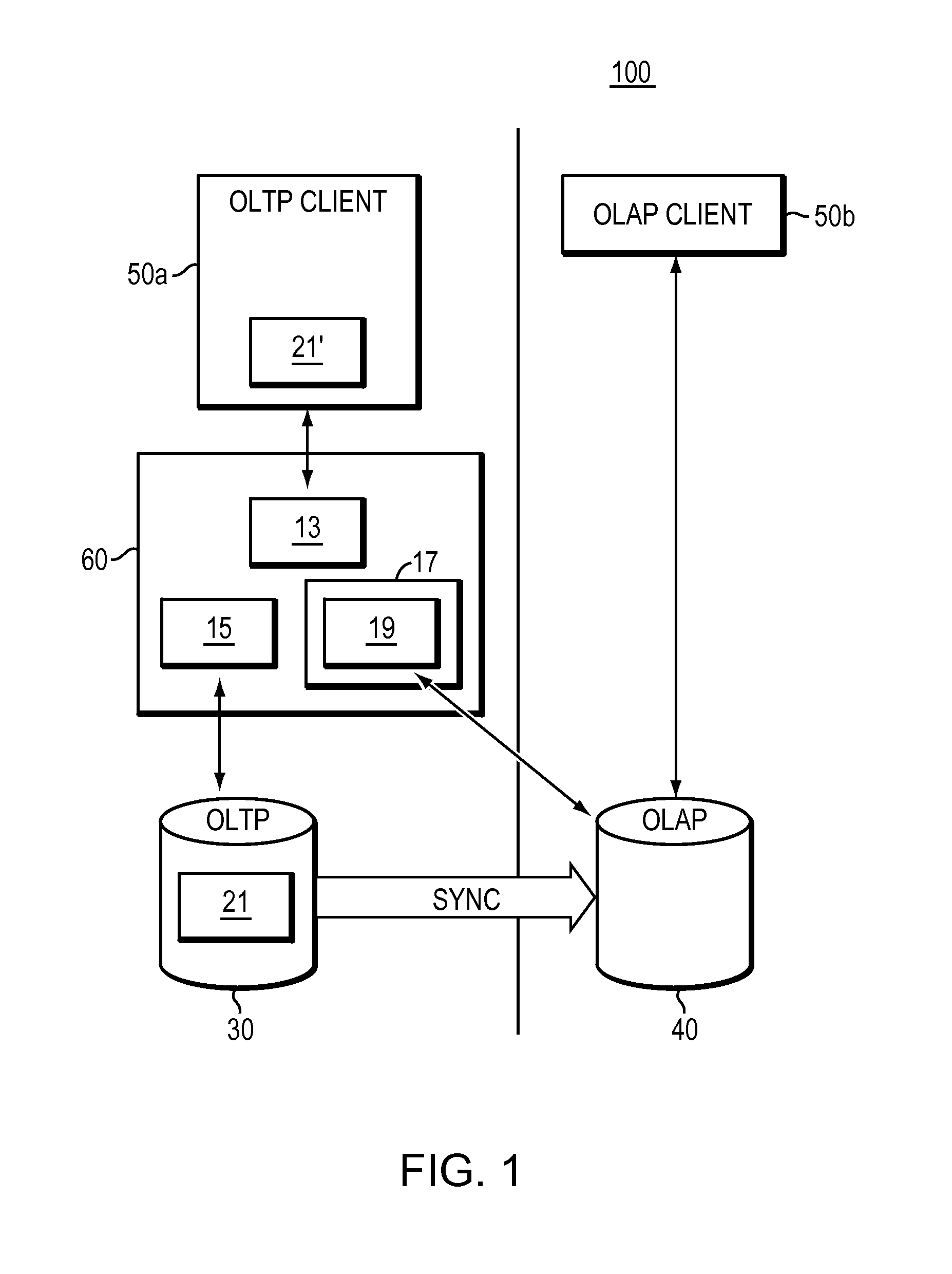

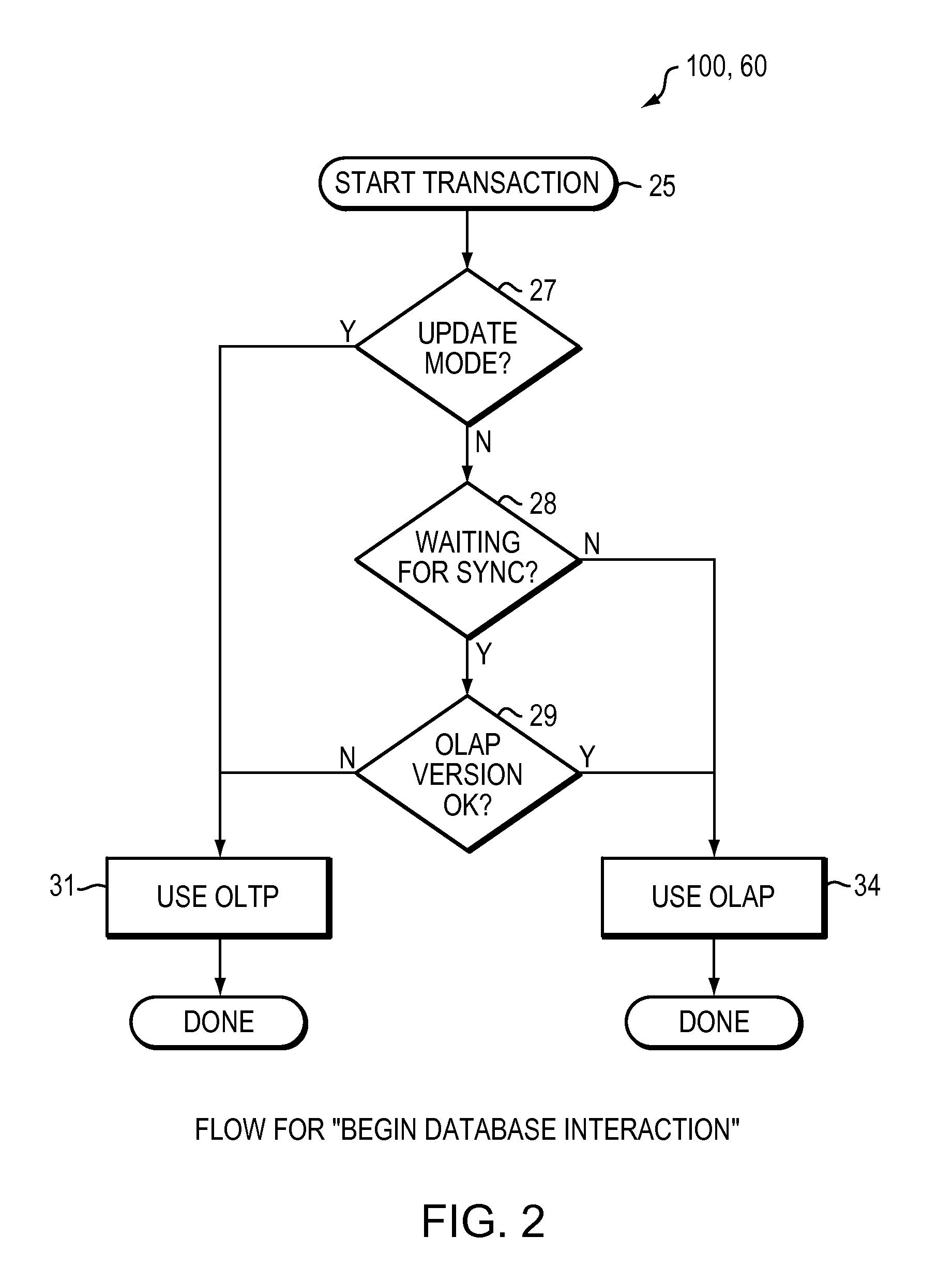

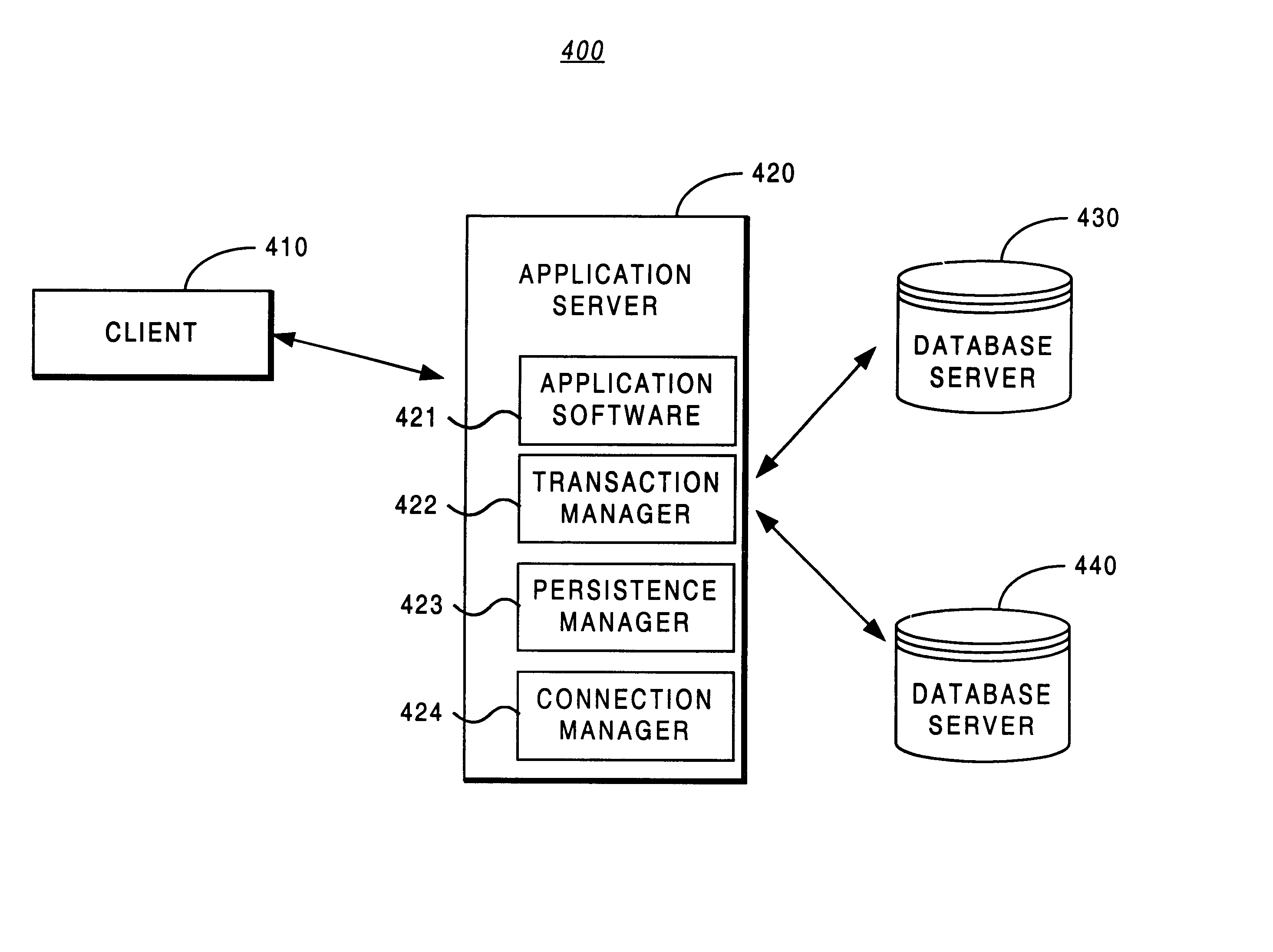

Computer method and system for combining OLTP database and OLAP database environments

ActiveUS8170981B1Database management systemsDigital data processing detailsApplication serverDatabase server

A computer system provides access to both an online transaction processing (OLTP) database server and an online analytics processing (OLAP) database server. The computer system includes a client application adapted to receive a query. According to (a) mode of operation (e.g., read or update) of the client application and (b) synchronization status of the OLAP database server, the client application redirects the query to the OLTP database server or to the OLAP database server. The client application redirects the query to the OLTP database server when the mode of operation is other than a read-only operation or the synchronization status is “unsynchronized”. The client application redirects the query to the OLAP database server when the mode of operation is a read-only operation and the synchronization status is “synchronized”. The computer system further includes an OLTP application server (e.g., Enovia V6) comprising an OLTP adapter and an OLAP adapter. The OLAP adapter is formed of a mapping component adapted to map data between OLTP semantics and OLAP semantics.

Owner:DASSAULT SYST AMERICAS CORP

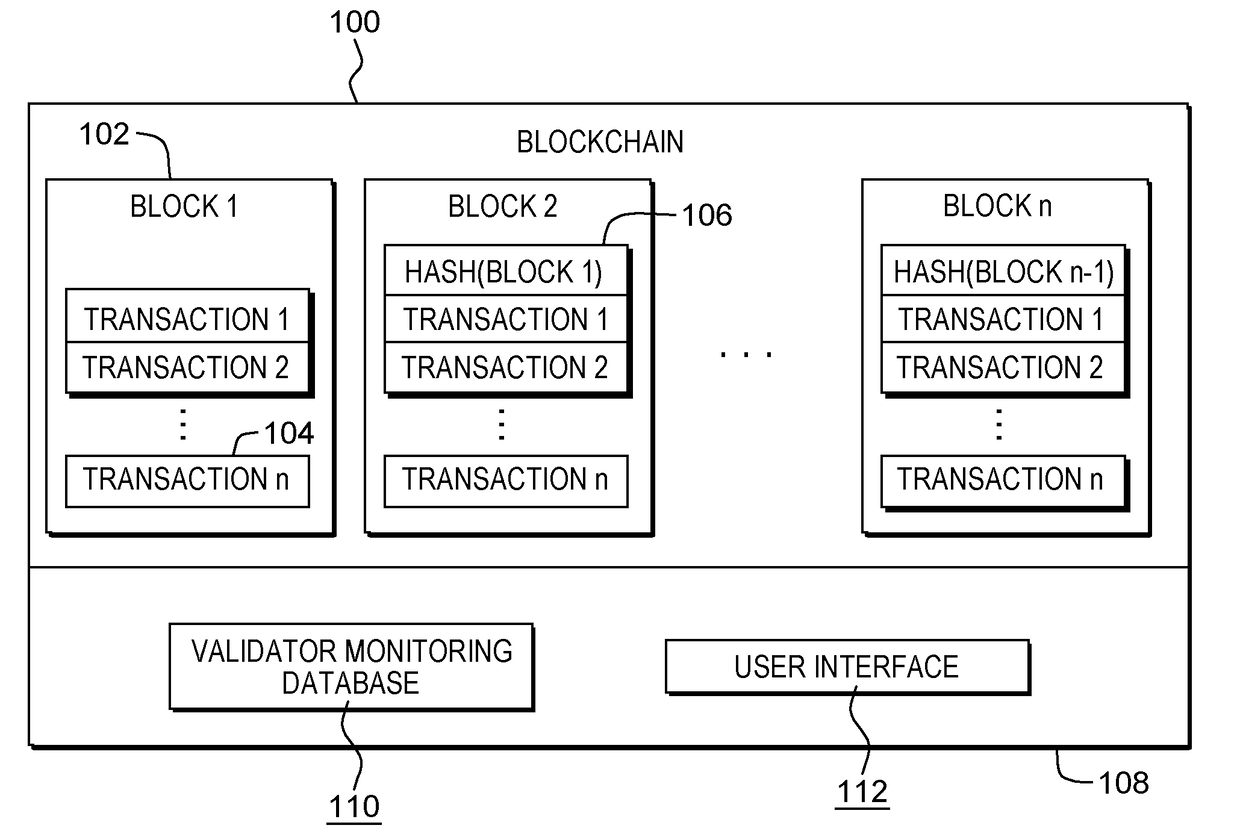

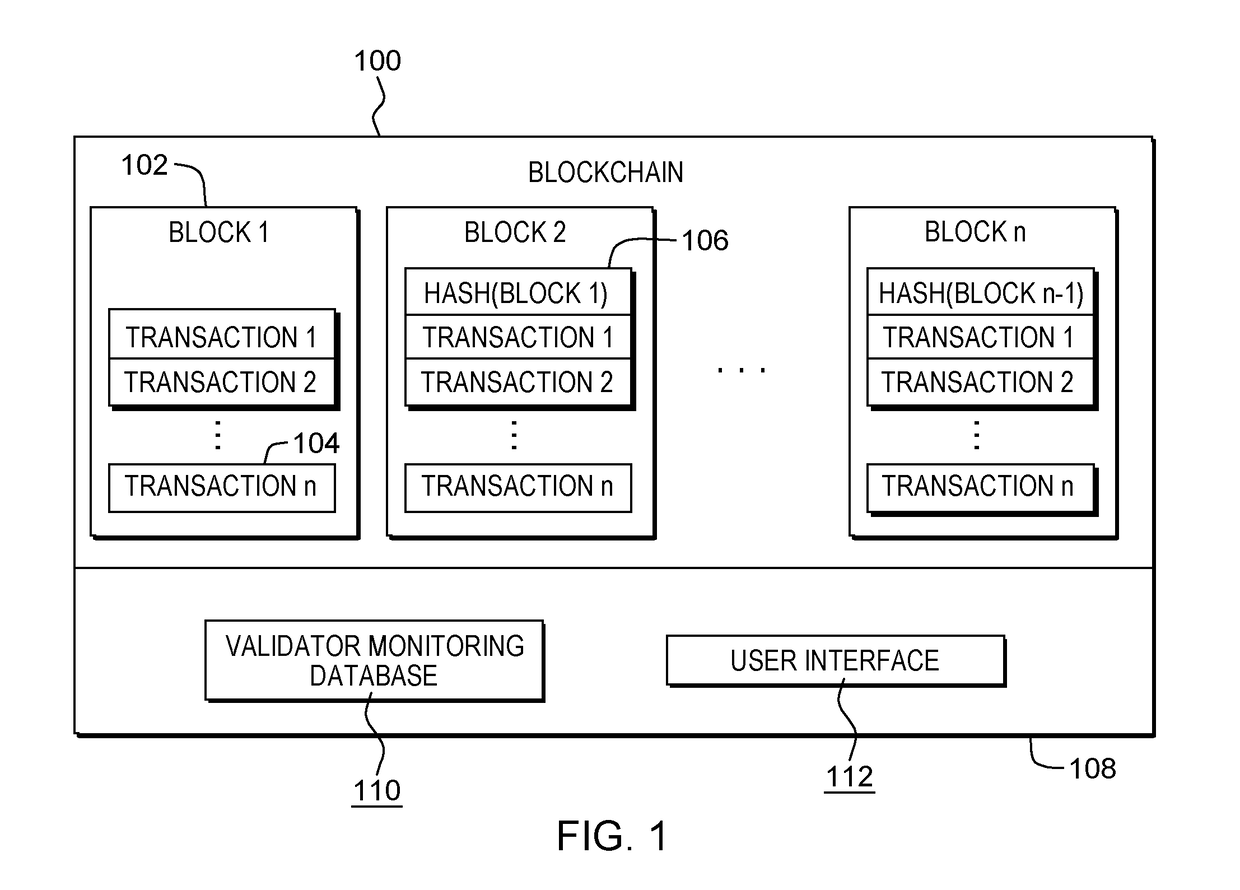

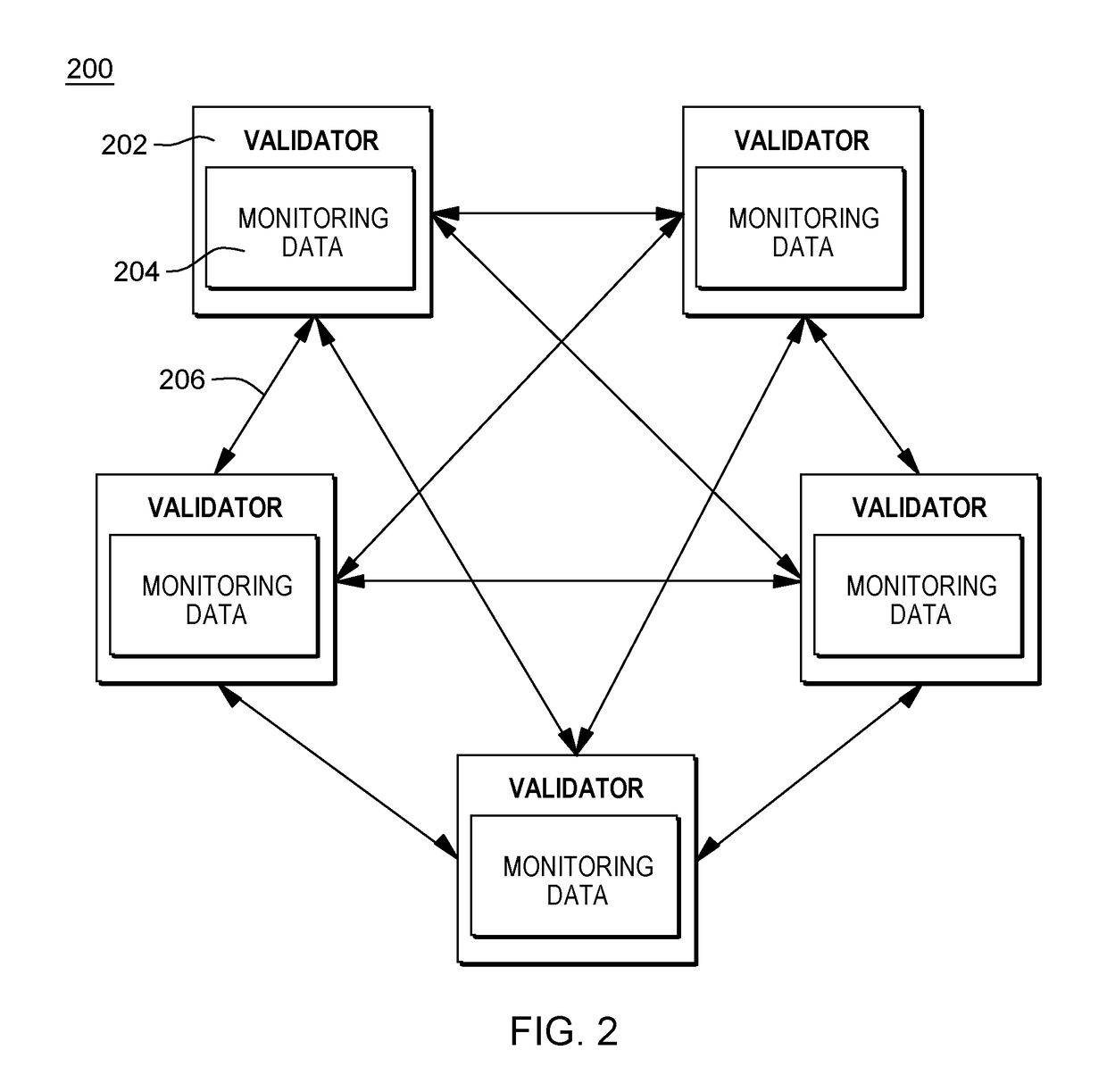

System and method to dynamically setup a private sub-blockchain based on agility of transaction processing

ActiveUS20180121909A1Encryption apparatus with shift registers/memoriesCryptography processingTransaction processing systemValidator

The creation of a private sub-blockchain from a main blockchain is disclosed including receiving a request including a trust requirement and an agility requirement, receiving monitoring data from at least one of a plurality of validator nodes of the main blockchain, the monitoring data generated by monitoring the execution of transactions and the exchange of consensus messages by one or more of the plurality of validator nodes, determining a minimum number of validator nodes required to meet the trust requirement, identifying a subset of the plurality of validator nodes of the main blockchain that meets the agility requirement based on the received monitoring data, the subset containing at least the determined minimum number of validator nodes required to meet the trust requirement, and creating a private sub-blockchain of the main blockchain, the private sub-blockchain including the identified subset of the plurality of validator nodes of the main blockchain.

Owner:IBM CORP

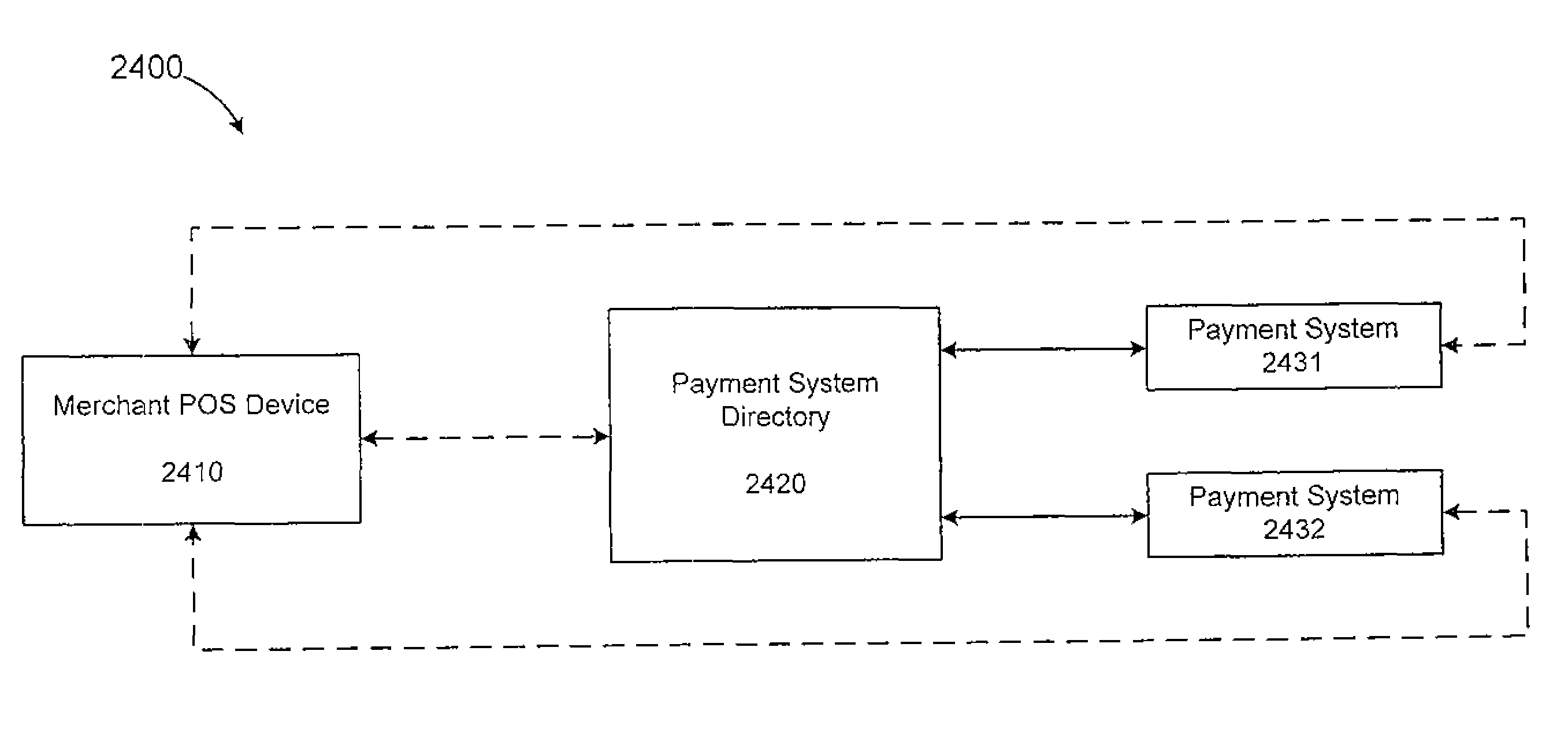

Systems and methods for transaction processing using a smartcard

InactiveUS8851369B2Convenient transactionComplete banking machinesFinanceSmart cardTransaction processing system

Facilitating commercial transactions using a payment system directory are disclosed. A payment directory and / or wireless point of sale (POS) device may be configured to use predetermined rules, a multitude of data items and / or conditions to locate a payment system, and transmit a payment authorization request from a remote location to at least one payment system, either directly, or via a payment system directory and / or a SSL Gateway. A smartcard may function as a payment directory and / or a payment system.

Owner:LIBERTY PEAK VENTURES LLC

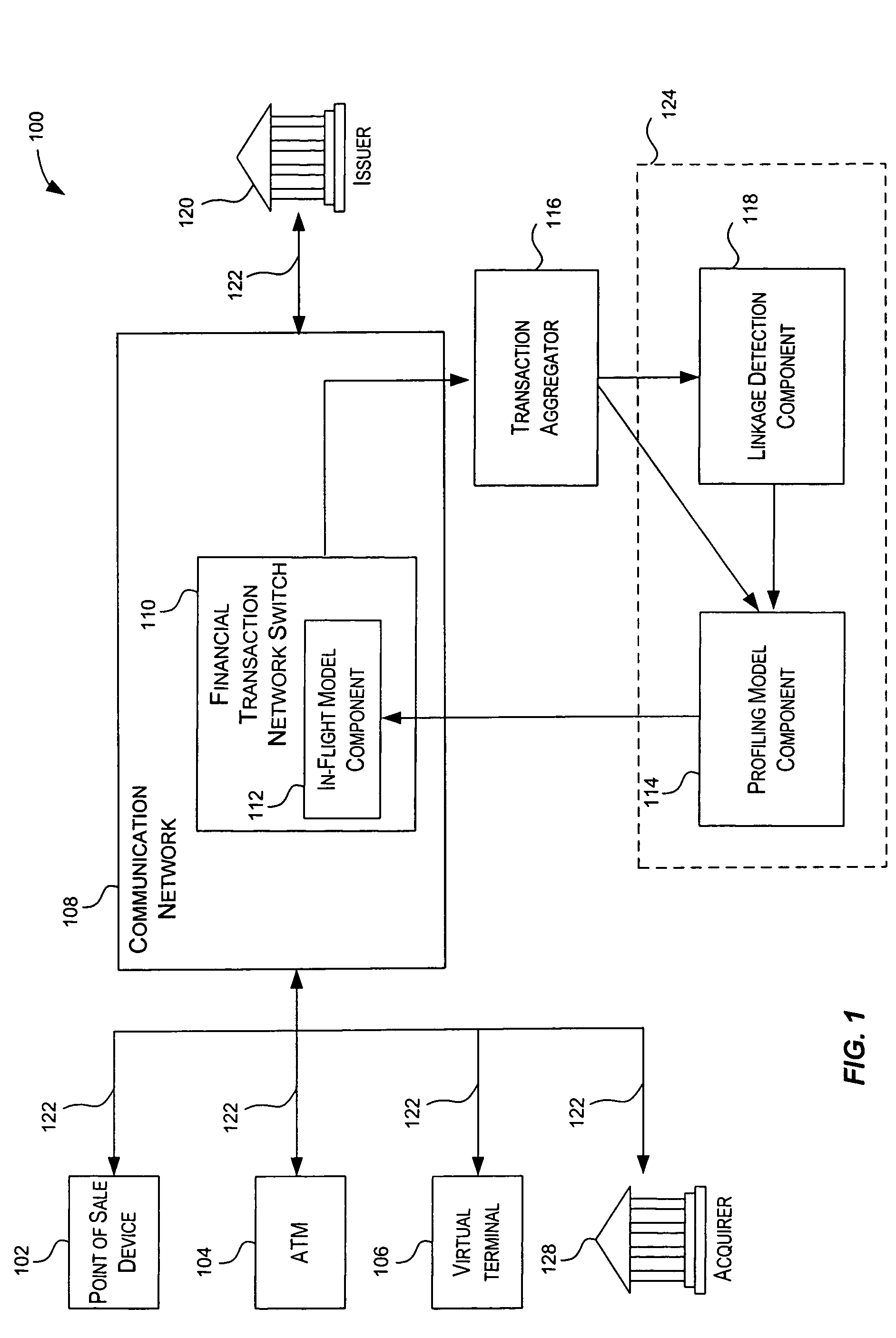

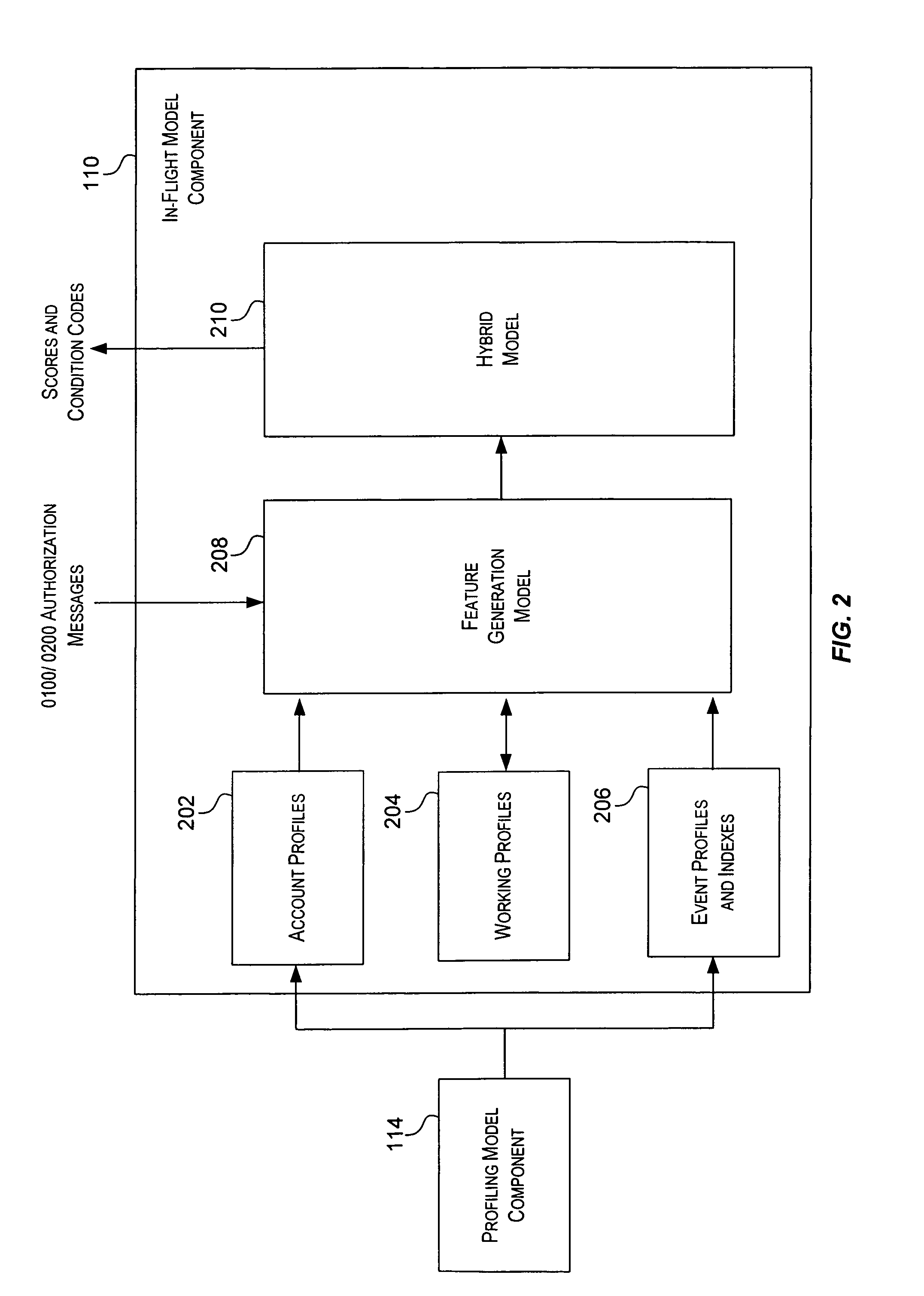

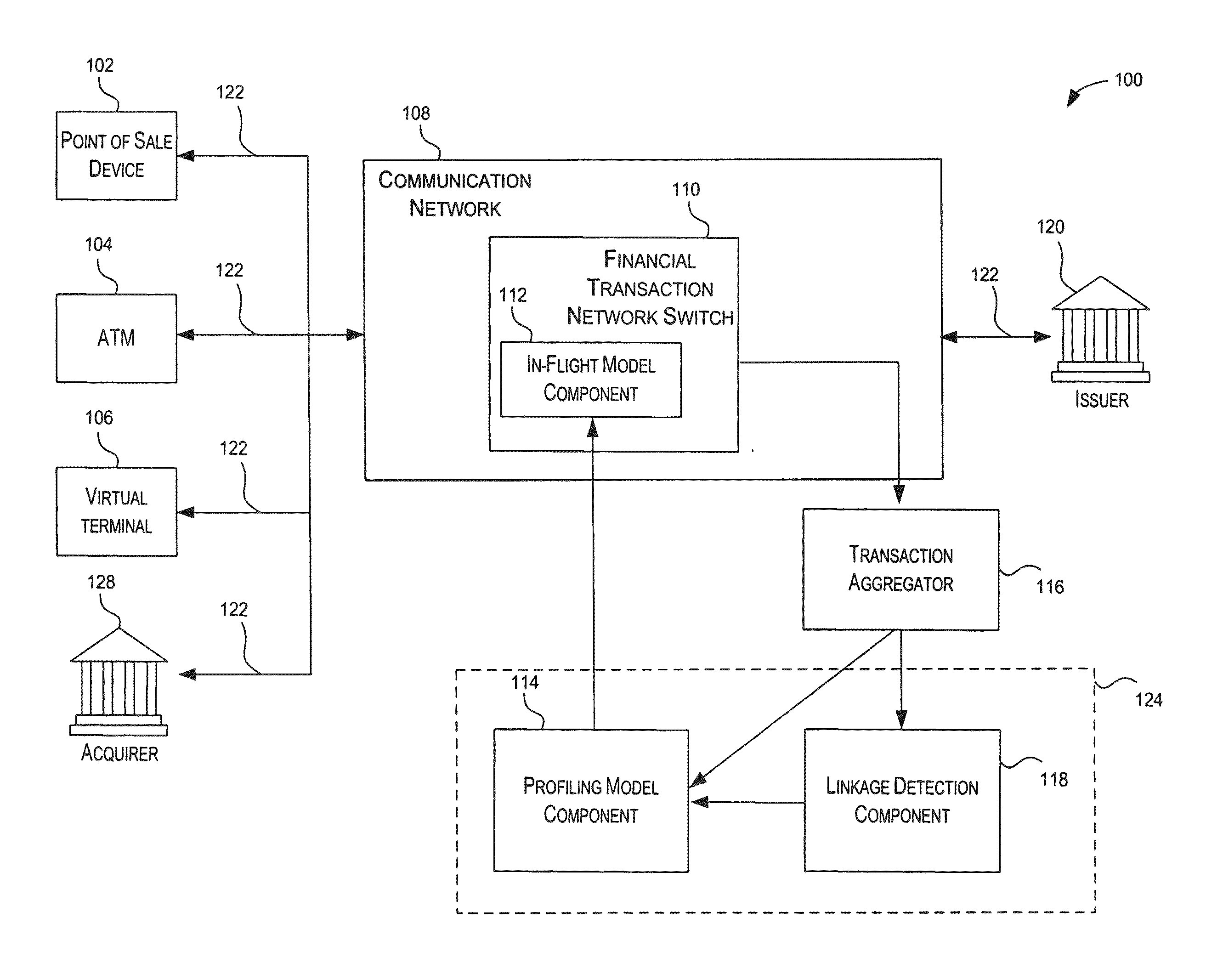

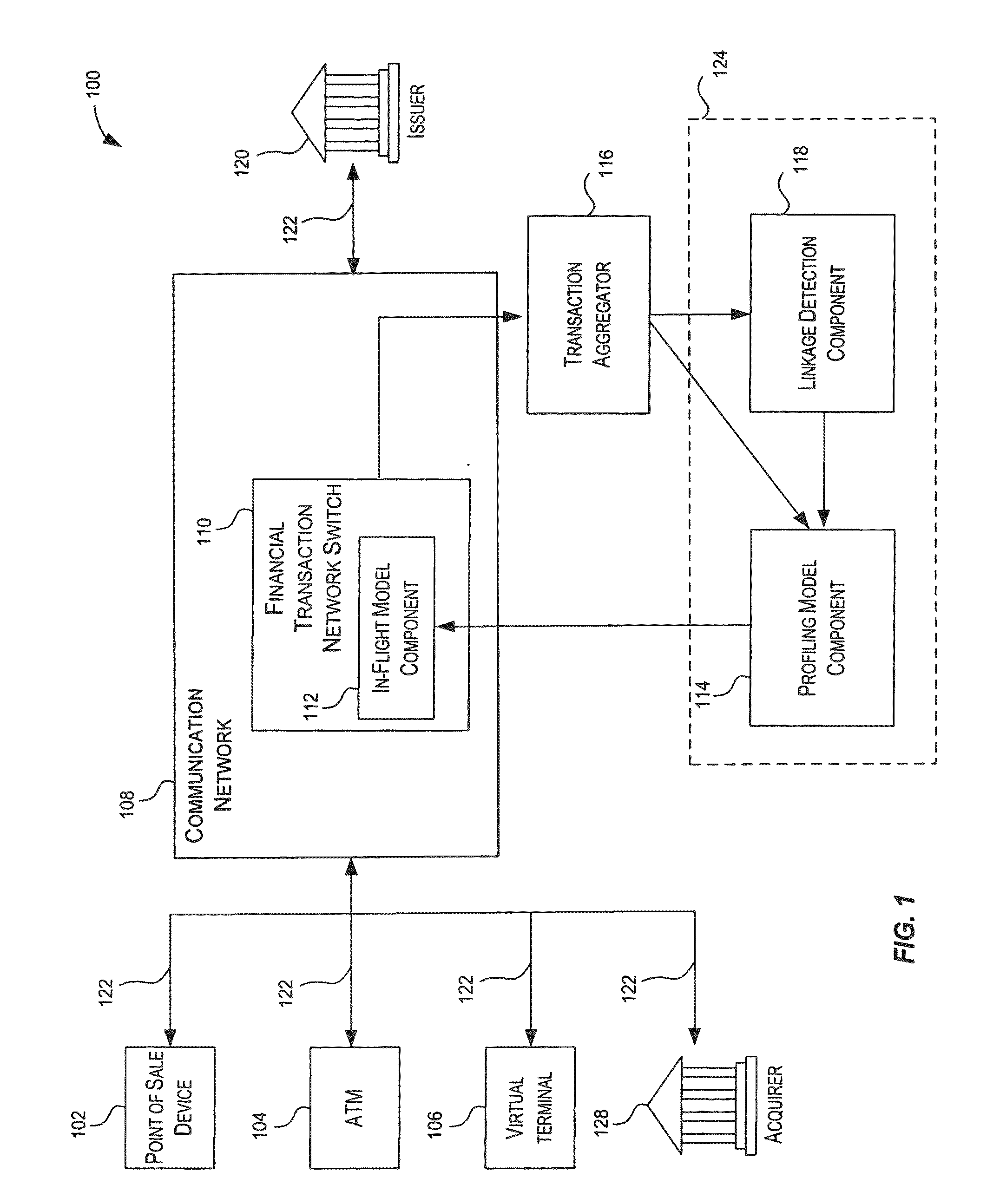

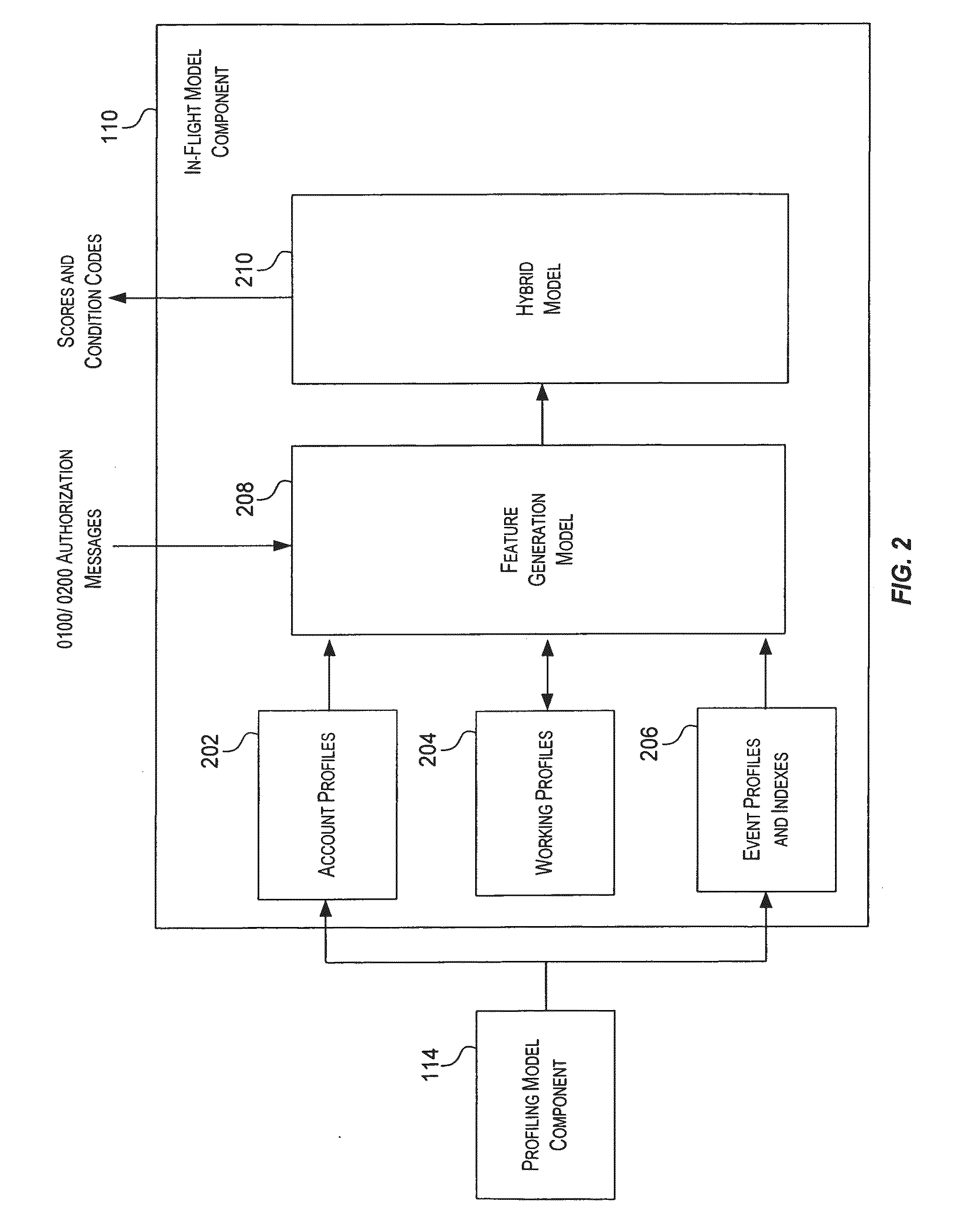

Method and system for providing risk information in connection with transaction processing

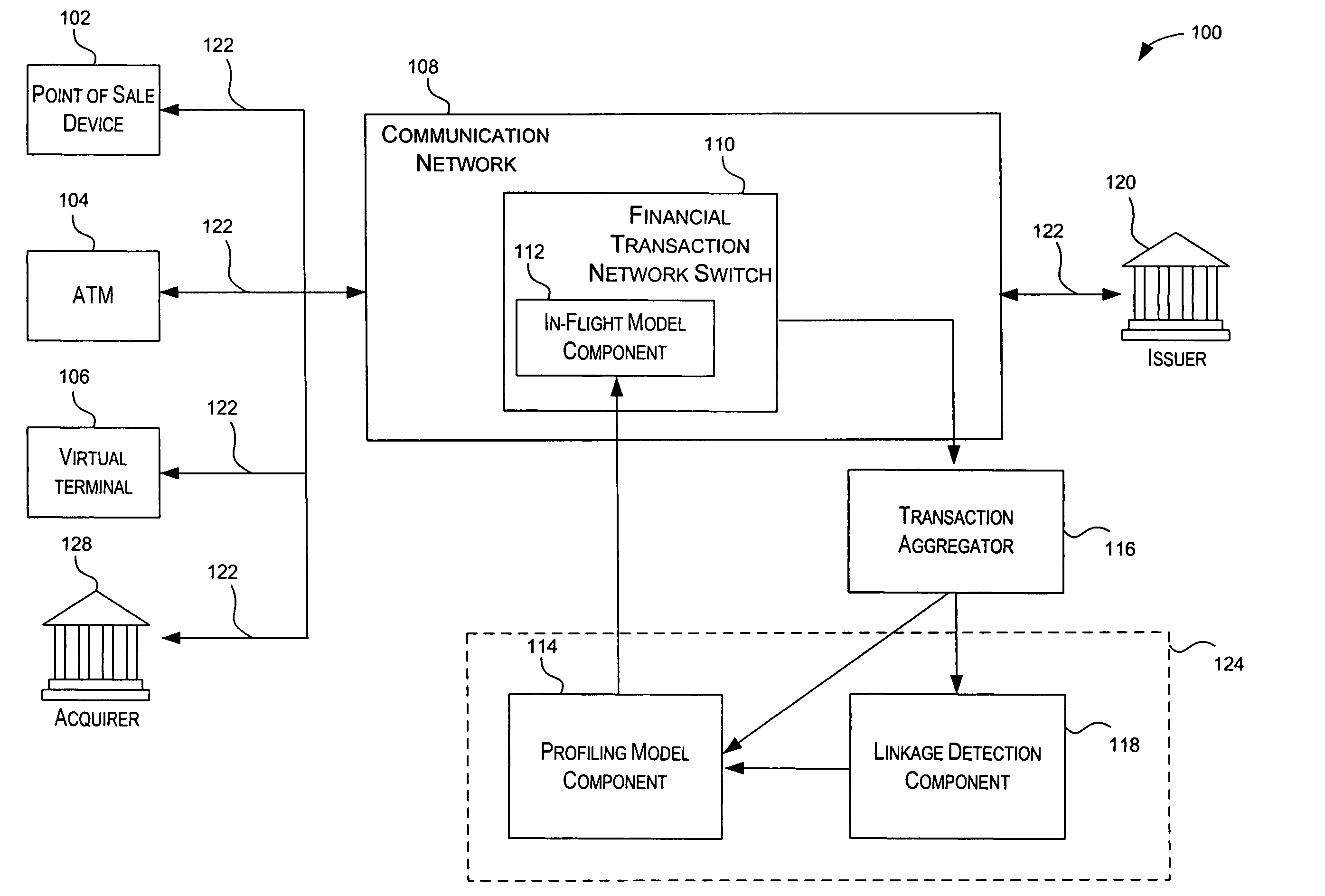

ActiveUS7809650B2Informed decisionFinanceDigital data processing detailsMultiple criteriaDecision taking

A system for providing real-time risk mitigation for an authorization system. The system receives authorization requests from multiple merchants (or their respective acquirers) and processes such requests. Each processed request is then forwarded to its corresponding issuer for further authorization. Each processed request includes an authorization message. The authorization message can include a risk score, a number of reason codes, and a number of condition codes. The use of the risk score, reason codes and condition codes allows issuers to make better informed decisions with respect to providing authorizations.

Owner:VISA USA INC (US)

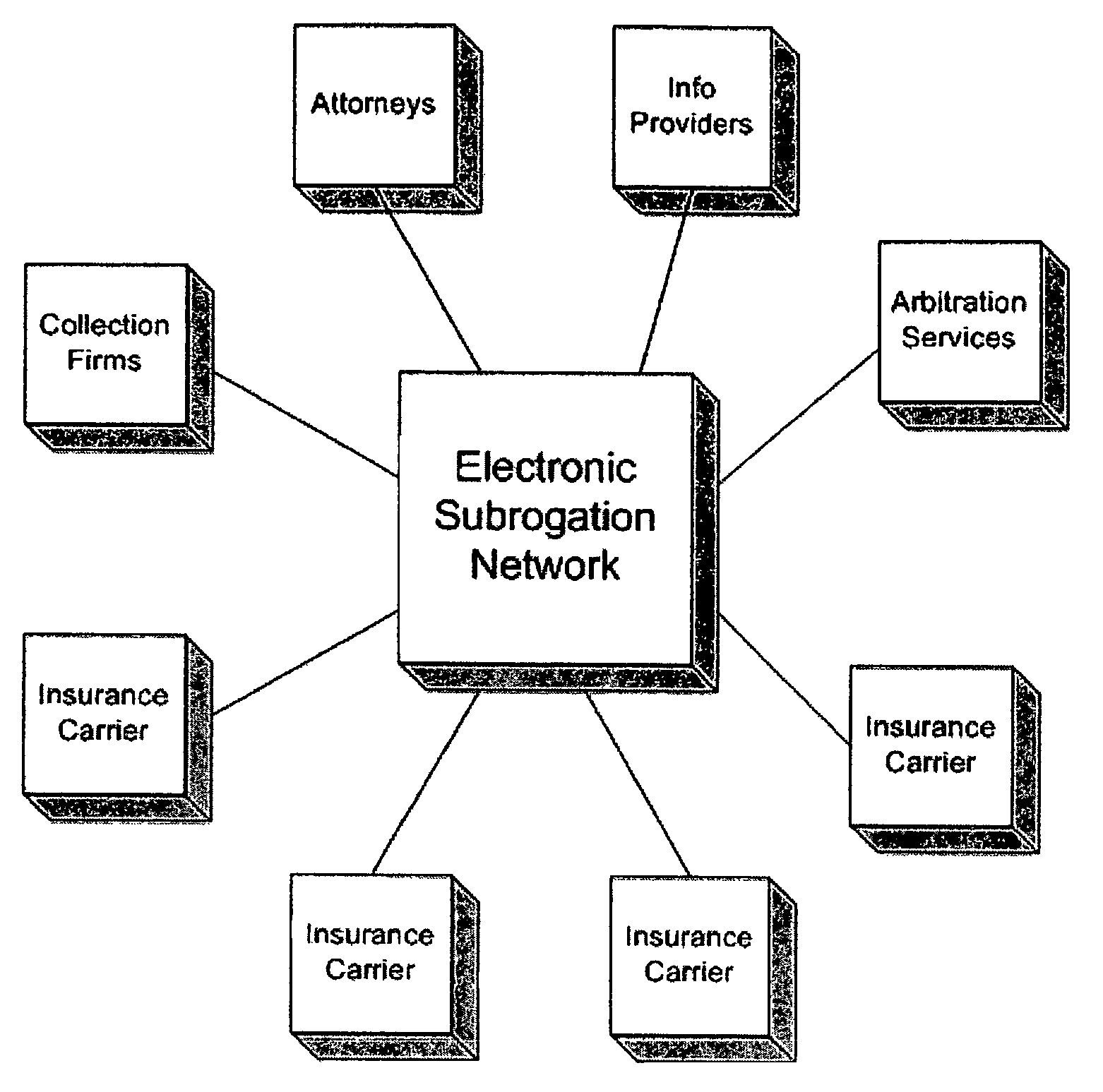

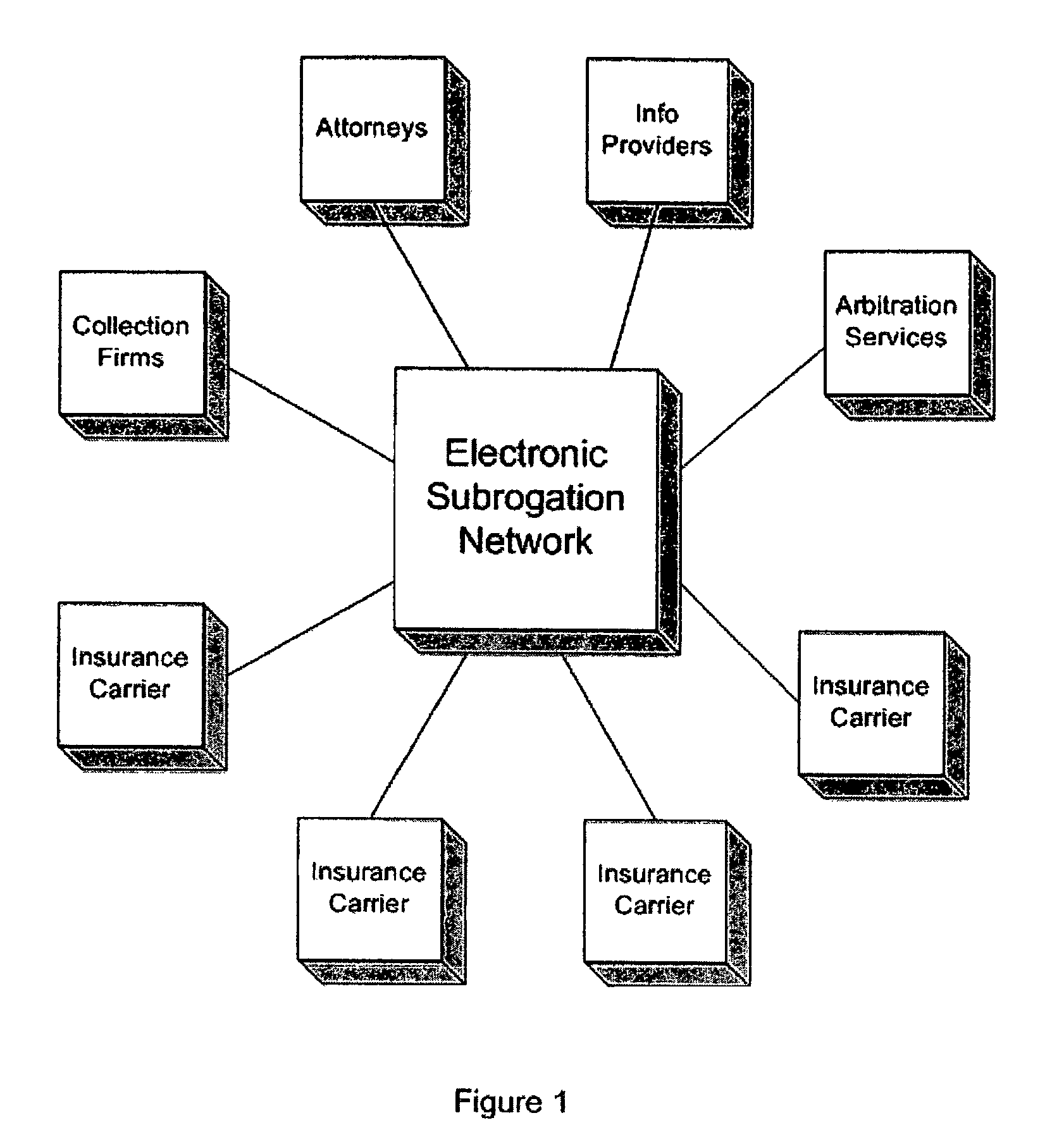

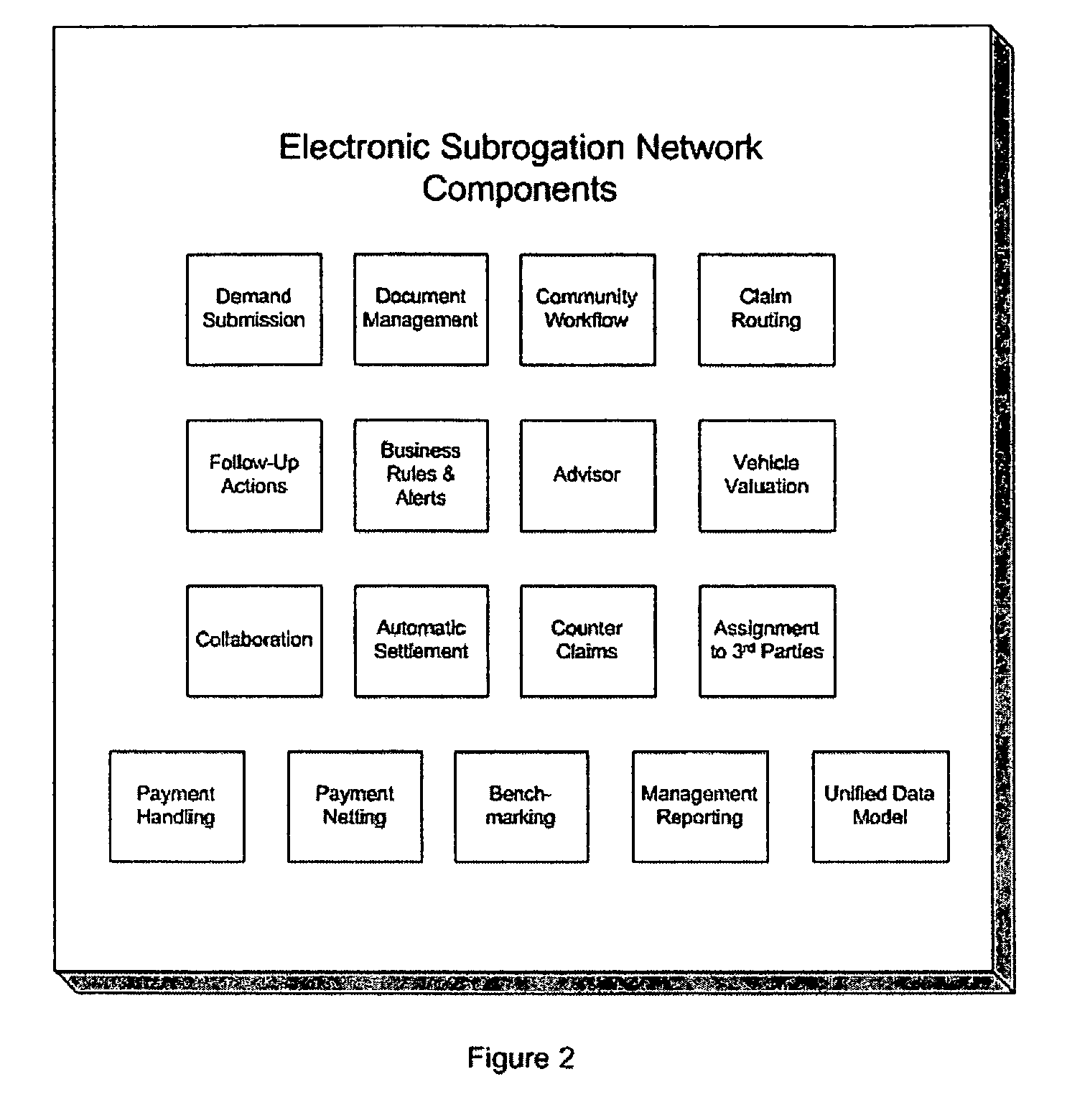

System and process for electronic subrogation, inter-organization workflow management, inter-organization transaction processing and optimized web-based user interaction

ActiveUS7962385B2Reduced processing power requirementsReduce message sizeFinanceOffice automationInter organizationalTransaction processing system

An intelligent electronic subrogation network (“ESN”) automates intra-organization workflow, inter-organization workflow and collaboration for insurance subrogation. This ESN is facilitated by a novel system architecture and process that includes an inter-organizational workflow management system, an inter-organizational transaction processing system, and a unique mechanism for optimizing and enriching web-based user interaction within any such system.

Owner:ARBITRATION FORUMS

Financial transaction processing system and method

InactiveUS7167924B1Easy to develop and modifyEasy to changeFinanceMultiple digital computer combinationsRelational databaseMessage routing

A financial transaction processing system (10) enables processing transactions from various types of card activated terminal devices (12) which communicate using a variety of electronic message formats. The transaction processing system may operate to authorize transactions internally using information stored in a relational database (32) or may communicate with external authorization systems (18). The transaction processing system includes among its software components message gateway routers (MGRs) (24, 164) which operate using information stored in the relational database to convert messages from a variety of external message formats used by the external devices and authorization systems, to a common internal message format used within the system. The system further uses database information to internally route messages to message processing programs (MPPs) (108, 138) which process messages and generate messages to the external devices and authorization systems. The MGR also converts the outgoing messages from the internal message format to the external message formats which can be interpreted by the external devices and systems to which the messages are directed.

Owner:DIEBOLD NIXDORF

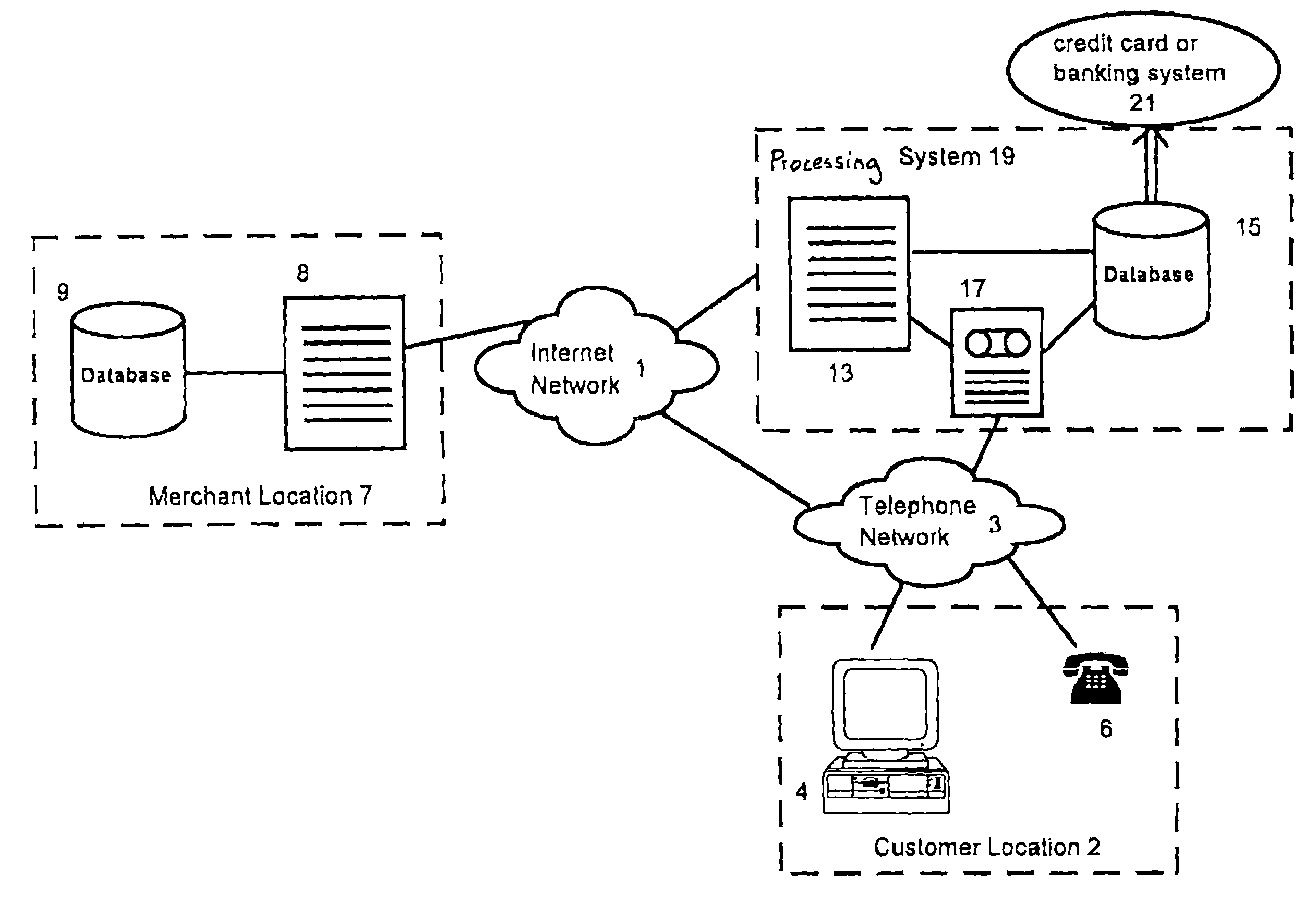

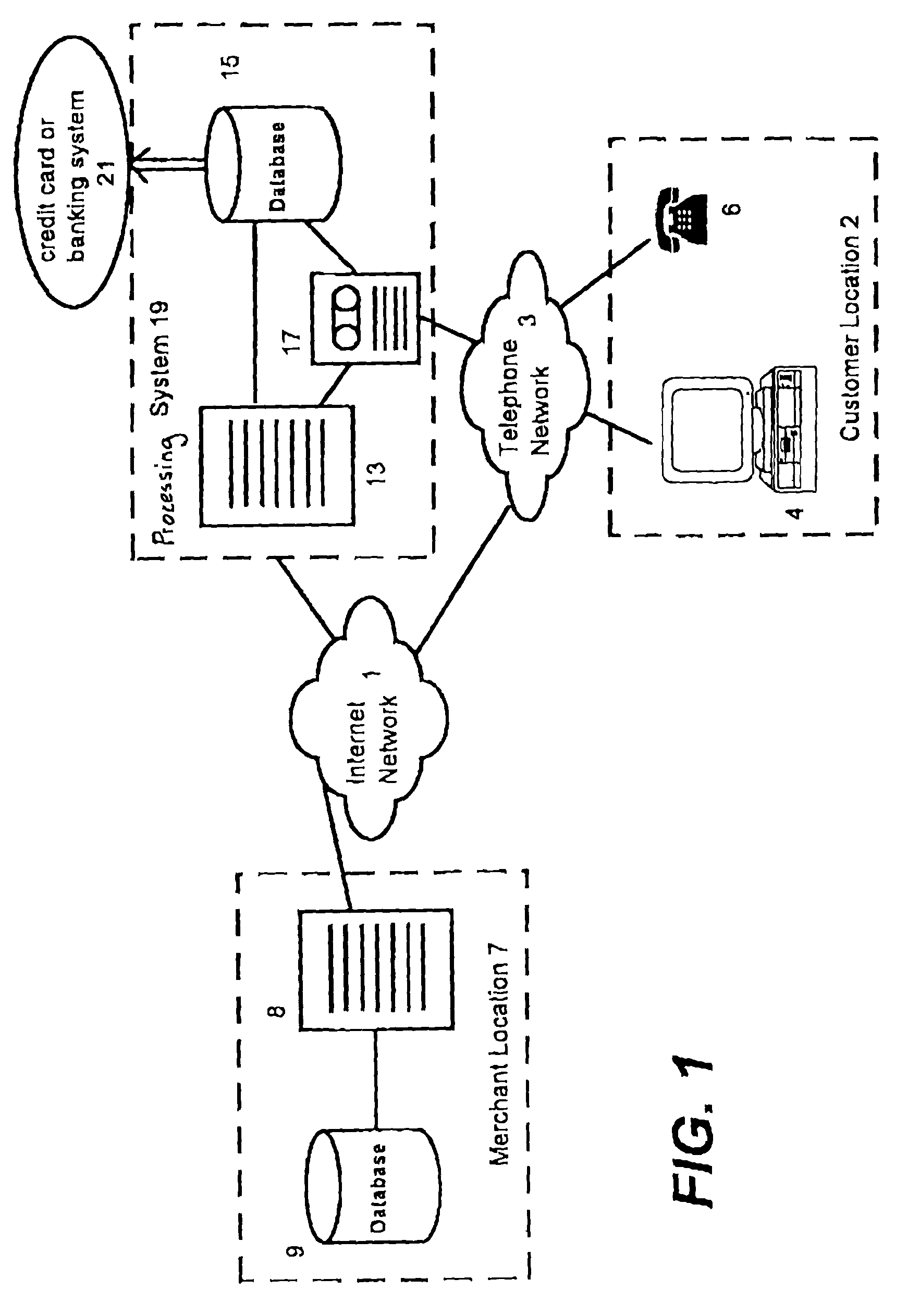

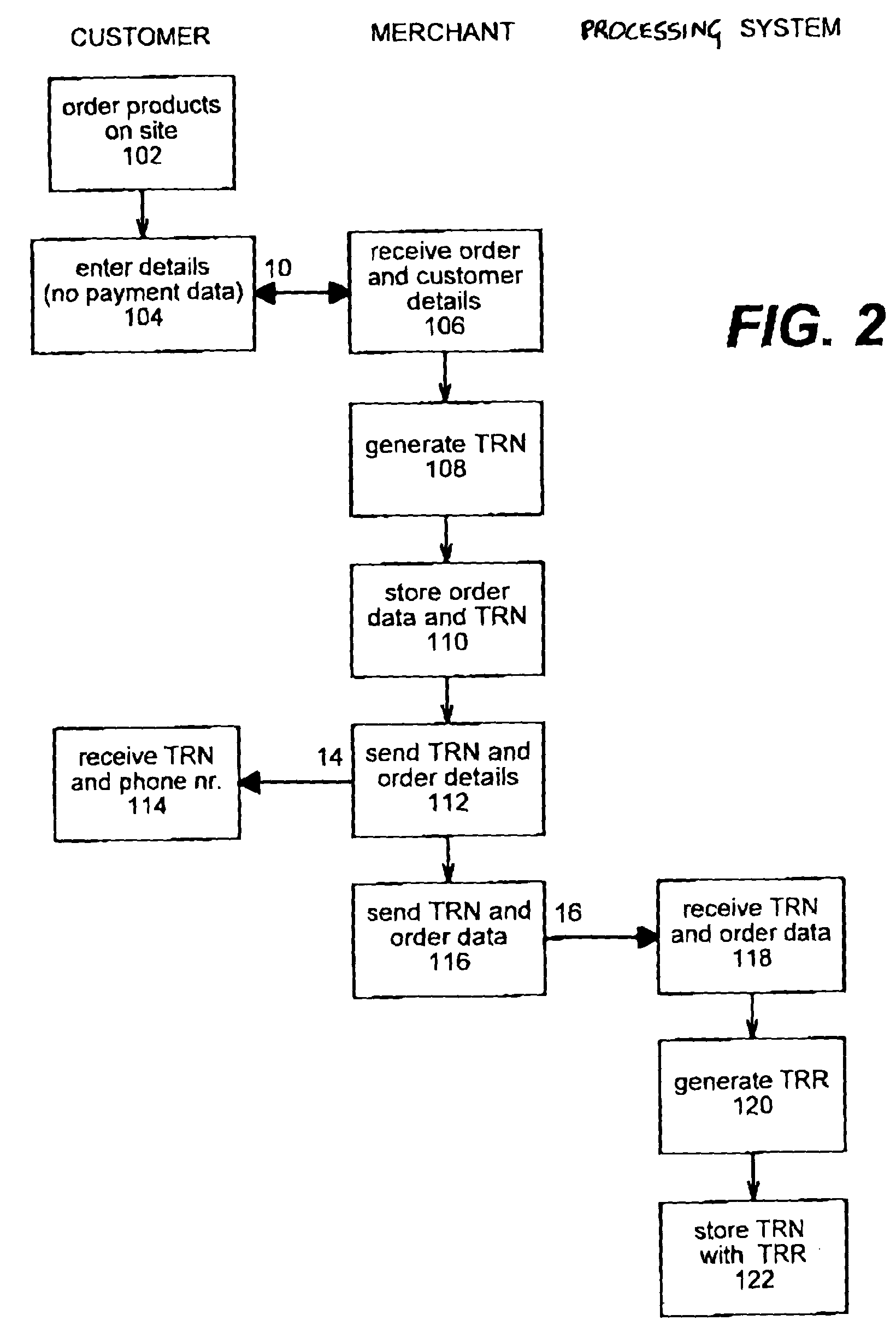

Transaction processing system

InactiveUS7447662B2Improve protectionCredit schemesSecret communicationPaymentTransaction processing system

A method of operating a transaction processing system (19) for confirming orders placed over a public data network (1), comprising: receiving first order references from a number of different merchant sites (7) via first data communication paths; receiving payment data and second order references from a number of customers via second communication paths different from said first communication path; and matching said first and second order references and settling payments.

Owner:VETT UK

Systems and methods for split tender transaction processing

InactiveUS20090265249A1Facilitates purchase transactionConvenient transactionHand manipulated computer devicesPayment circuitsAuthorizationPayment system

Facilitating commercial transactions using a payment system directory are disclosed. A payment directory and / or wireless point of sale (POS) device may be configured to use predetermined rules, a multitude of data items and / or conditions to locate a payment system, and transmit a payment authorization request from a remote location to at least one payment system, either directly, or via a payment system directory and / or a SSL Gateway.

Owner:LIBERTY PEAK VENTURES LLC +1

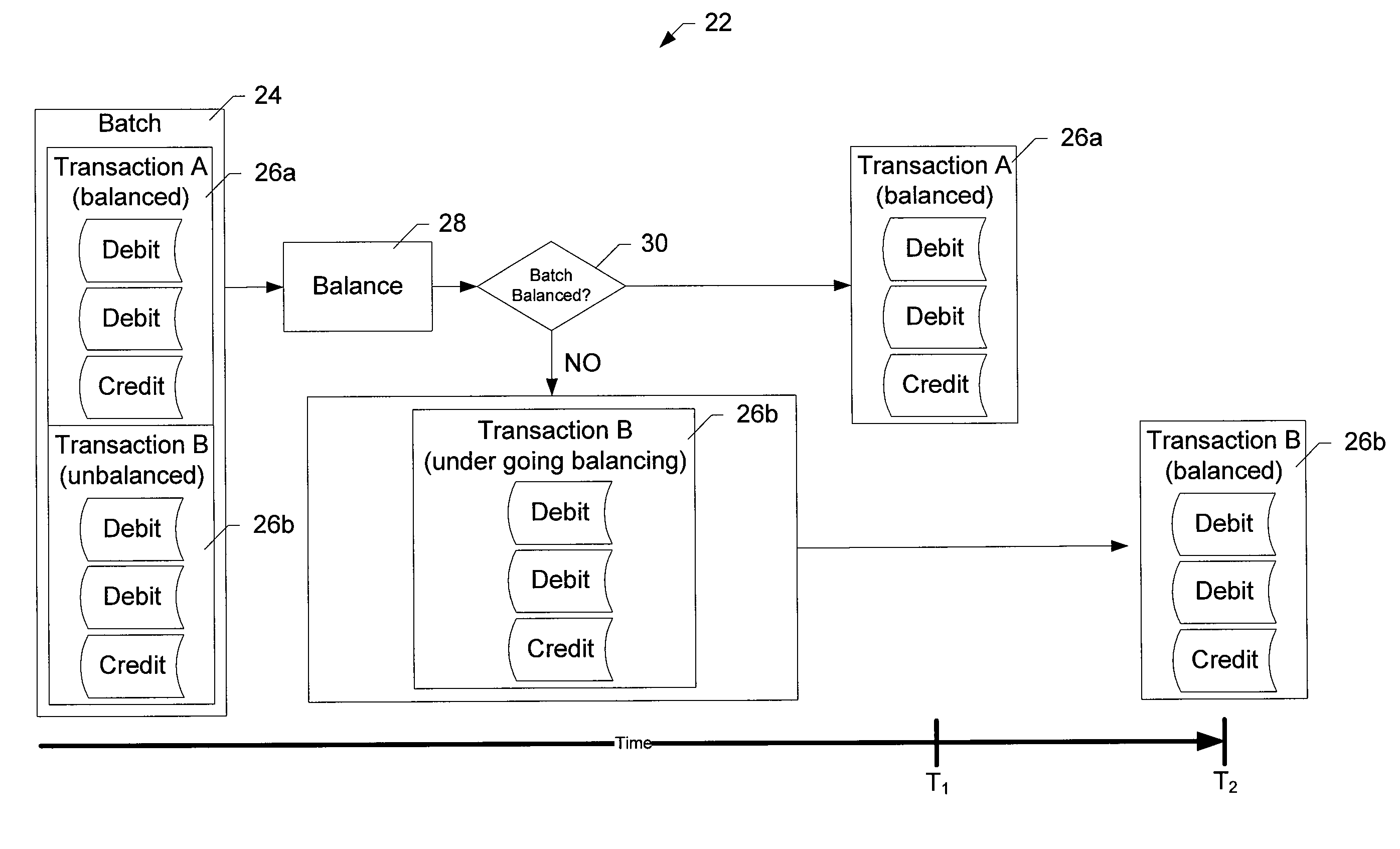

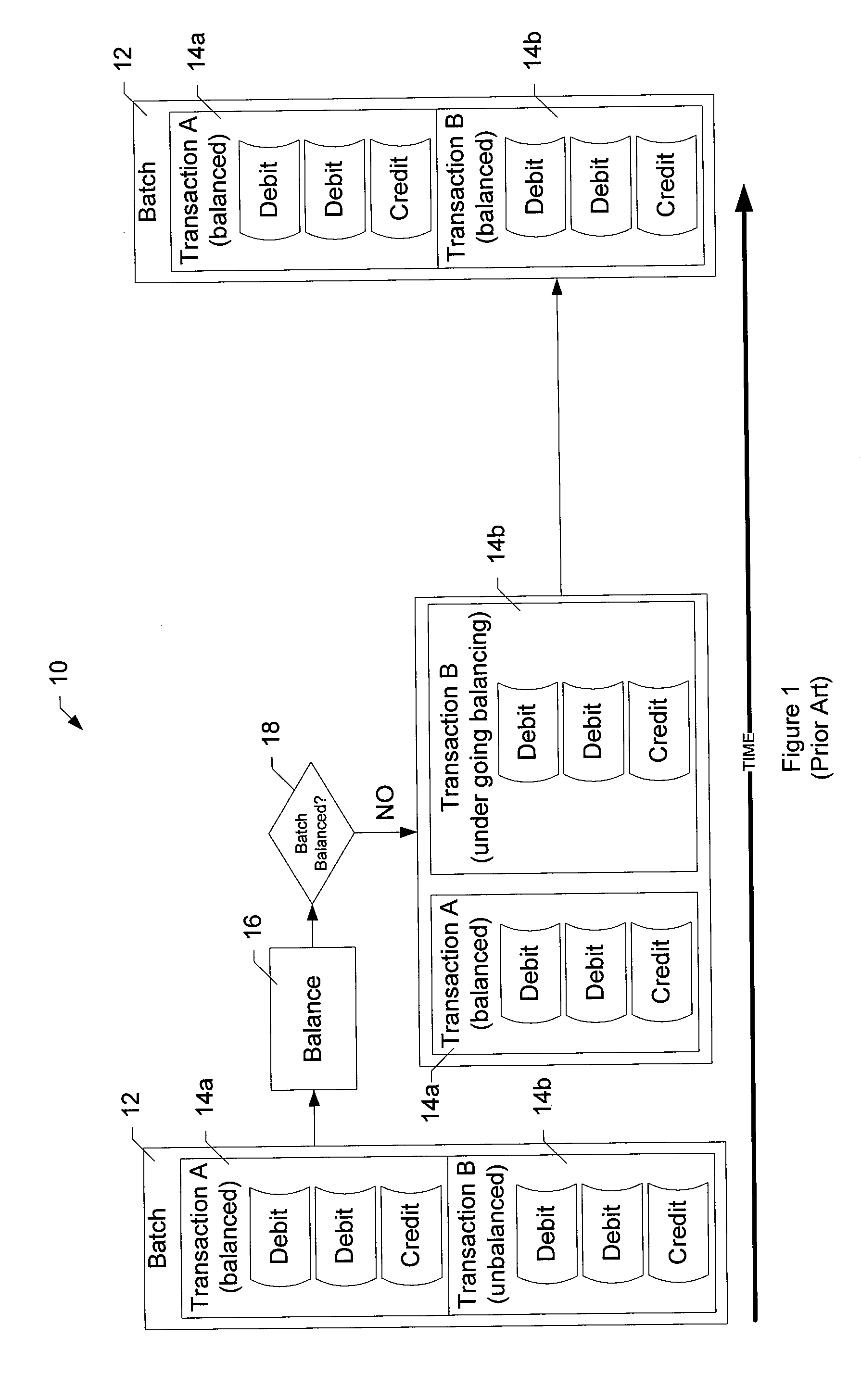

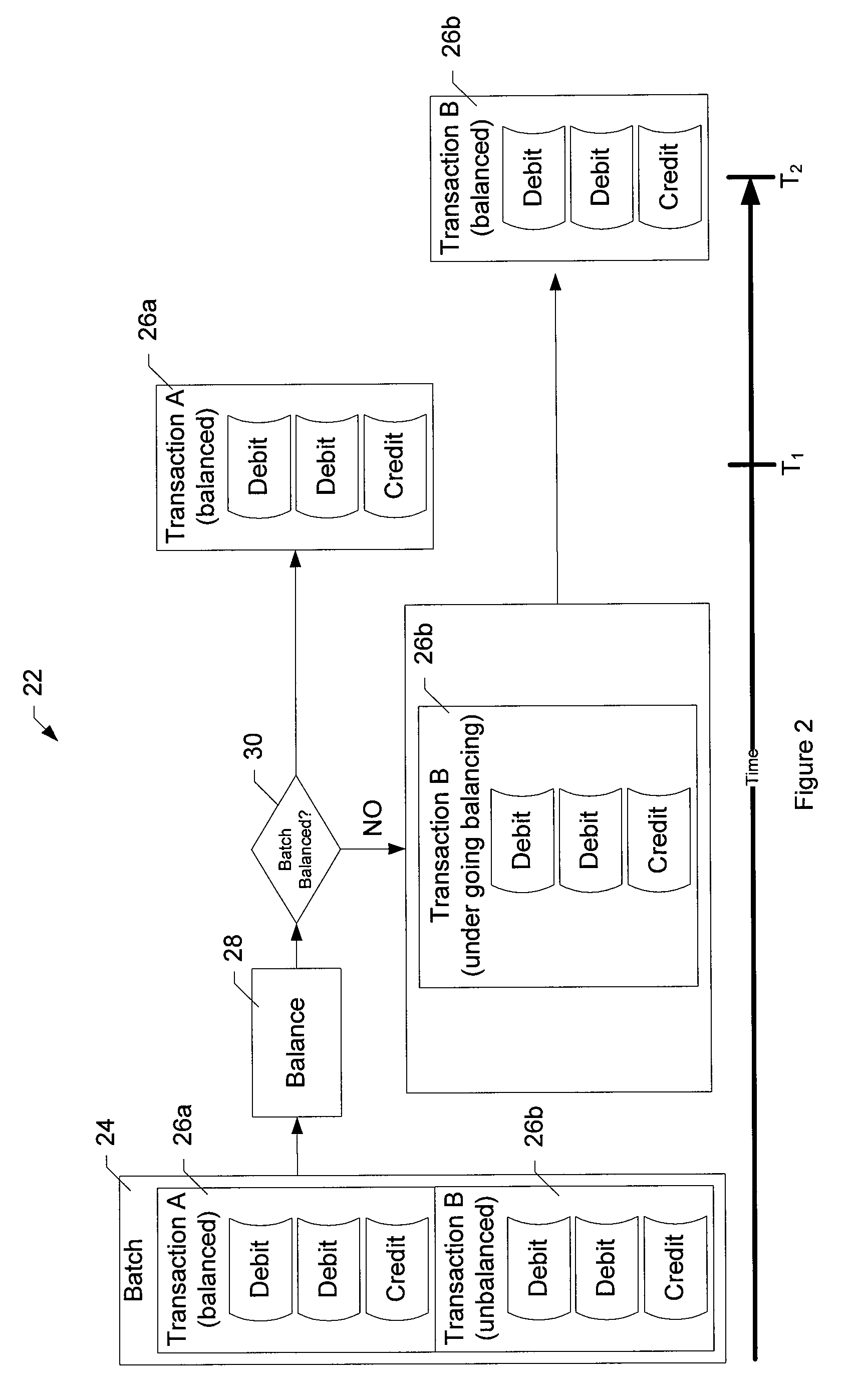

Systems, methods, and computer program products for performing item level transaction processing

ActiveUS20090292628A1Facilitate processing of transactionEfficient processing of transactionComplete banking machinesFinanceFinancial transactionDatabase

The present invention provides systems, methods, and computer program products for performing validation and clearance at a transaction item level for transaction received in a batch format. Each transaction of the batch is stored separately in a storage system, such as a logical database. Typically, image data and electronic data for a transaction are stored separately in the storage system and may be linked to each other. Each transaction is separately accessible and / or updateable. Each transaction stored in the storage system is separately analyzed to validate that the transaction is at least balanced. Transactions that determined to be balanced are cleared irrespective of a balance status associated with other transactions associated with the batch of transactions, such that transactions are individually cleared as opposed to being cleared in a batch format.

Owner:BANK OF AMERICA CORP

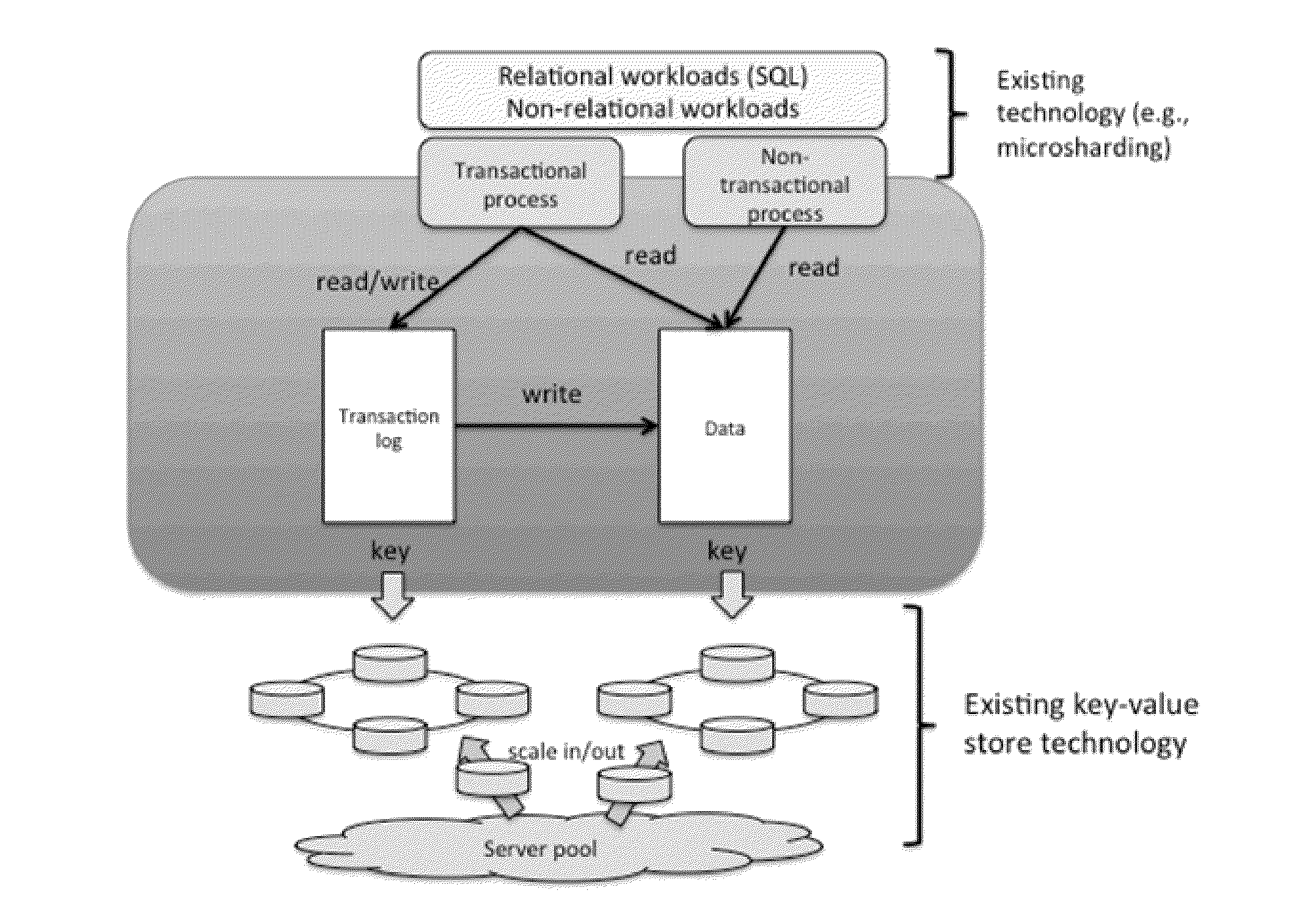

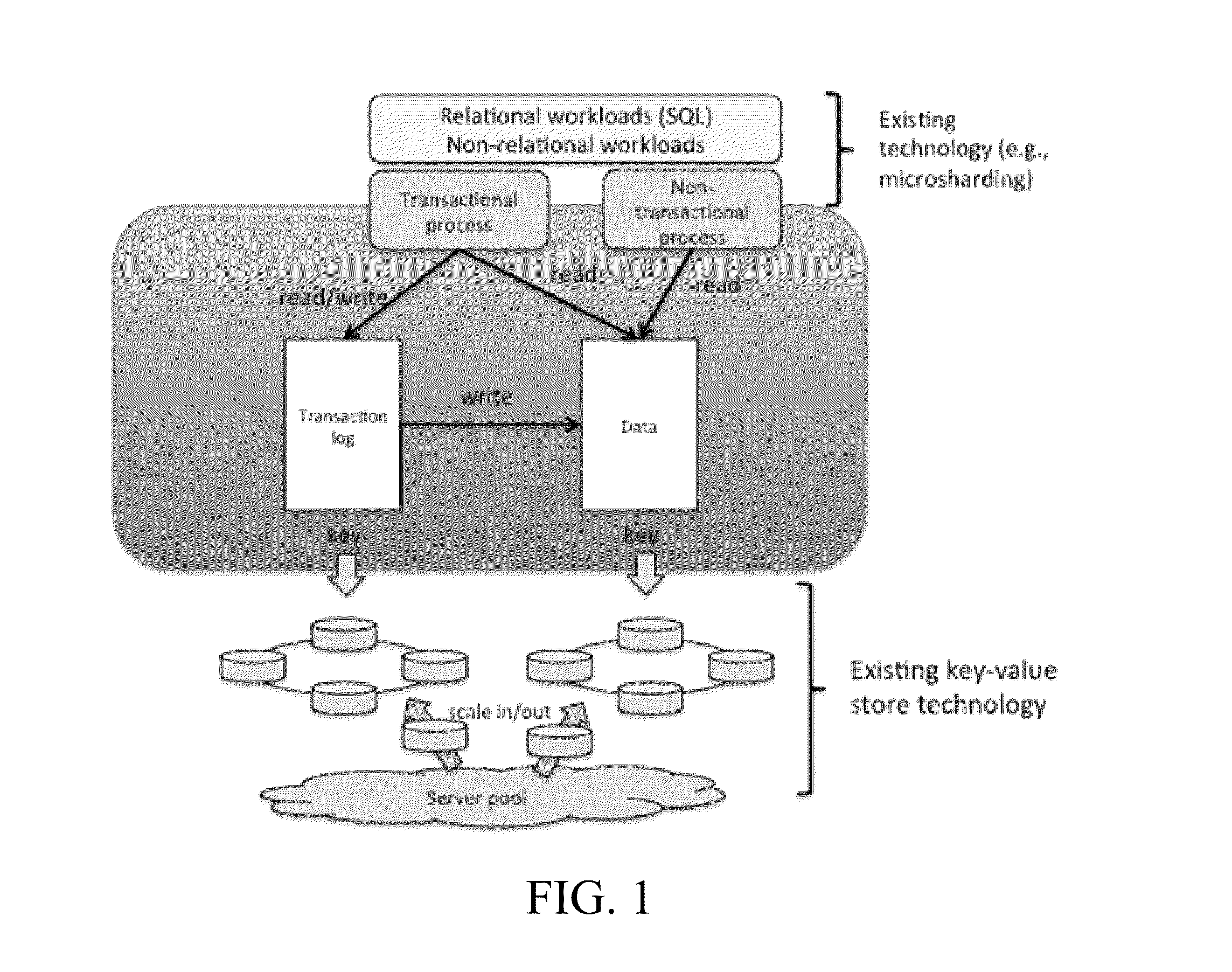

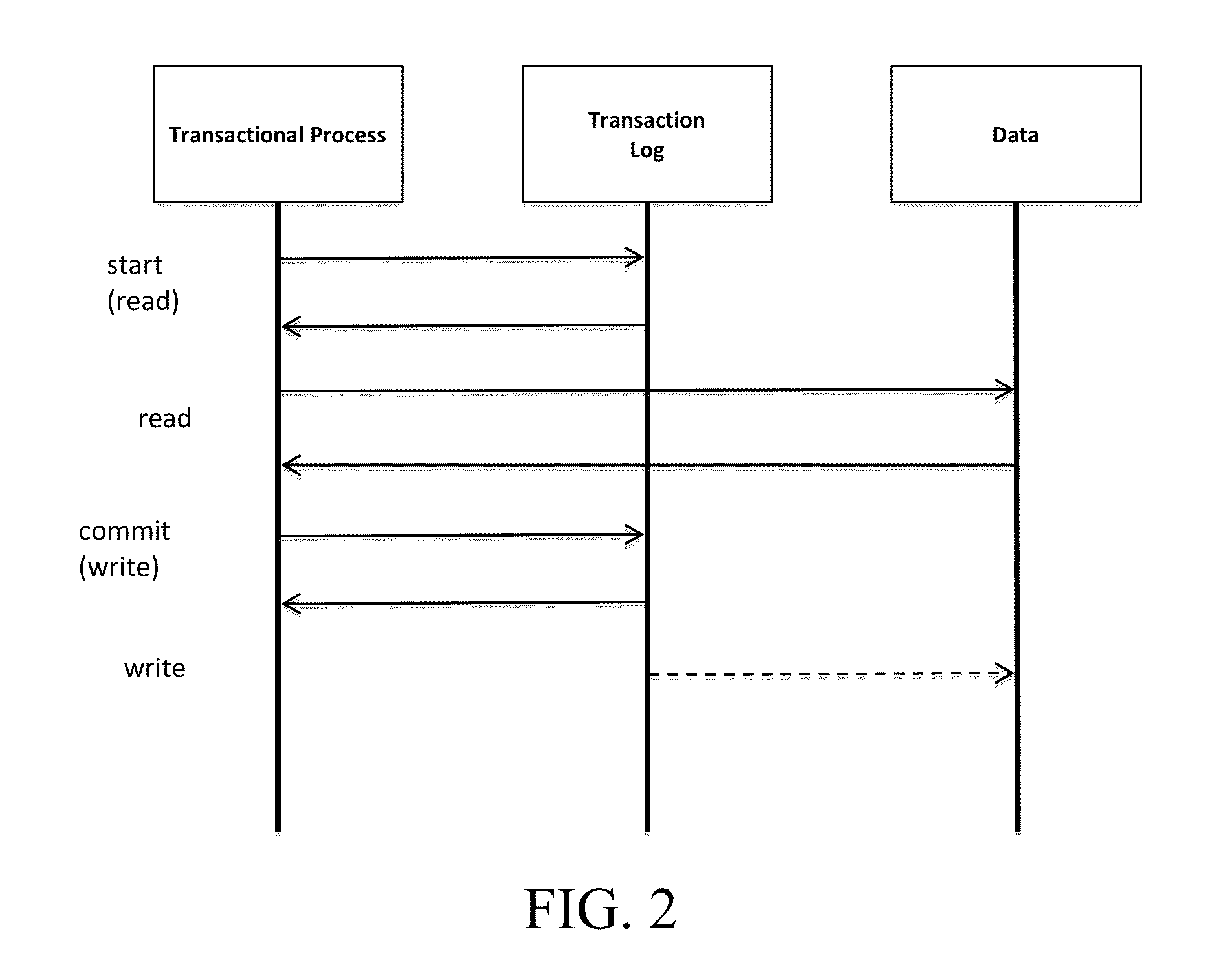

Online Transaction Processing

InactiveUS20130110767A1ElasticityDigital data processing detailsDatabase distribution/replicationTransaction logOnline trading

A method implemented in an online transaction processing system is disclosed. The method includes, upon a read request from a transaction process, reading a transaction log, reading data stored in a storage without accessing the transaction log, and constituting a current snapshot using the data in the storage and the transaction log. The method also includes, upon a write request from the transaction process, committing transaction by accessing the transaction log. The method also includes propagating update in the commit to the data in the storage asynchronously. The transaction commit is made successful upon applying the commit to the transaction log. Other methods and systems also are disclosed.

Owner:NEC LAB AMERICA

Systems and methods for maximizing a rewards accumulation strategy during transaction processing

InactiveUS20090287564A1Convenient transactionHand manipulated computer devicesFinanceTransaction processing systemAuthorization

Facilitating commercial transactions using a payment system directory are disclosed. A payment directory and / or wireless point of sale (POS) device may be configured to use predetermined rules, a multitude of data items and / or conditions to locate a payment system, and transmit a payment authorization request from a remote location to at least one payment system, either directly, or via a payment system directory and / or a SSL Gateway.

Owner:LIBERTY PEAK VENTURES LLC

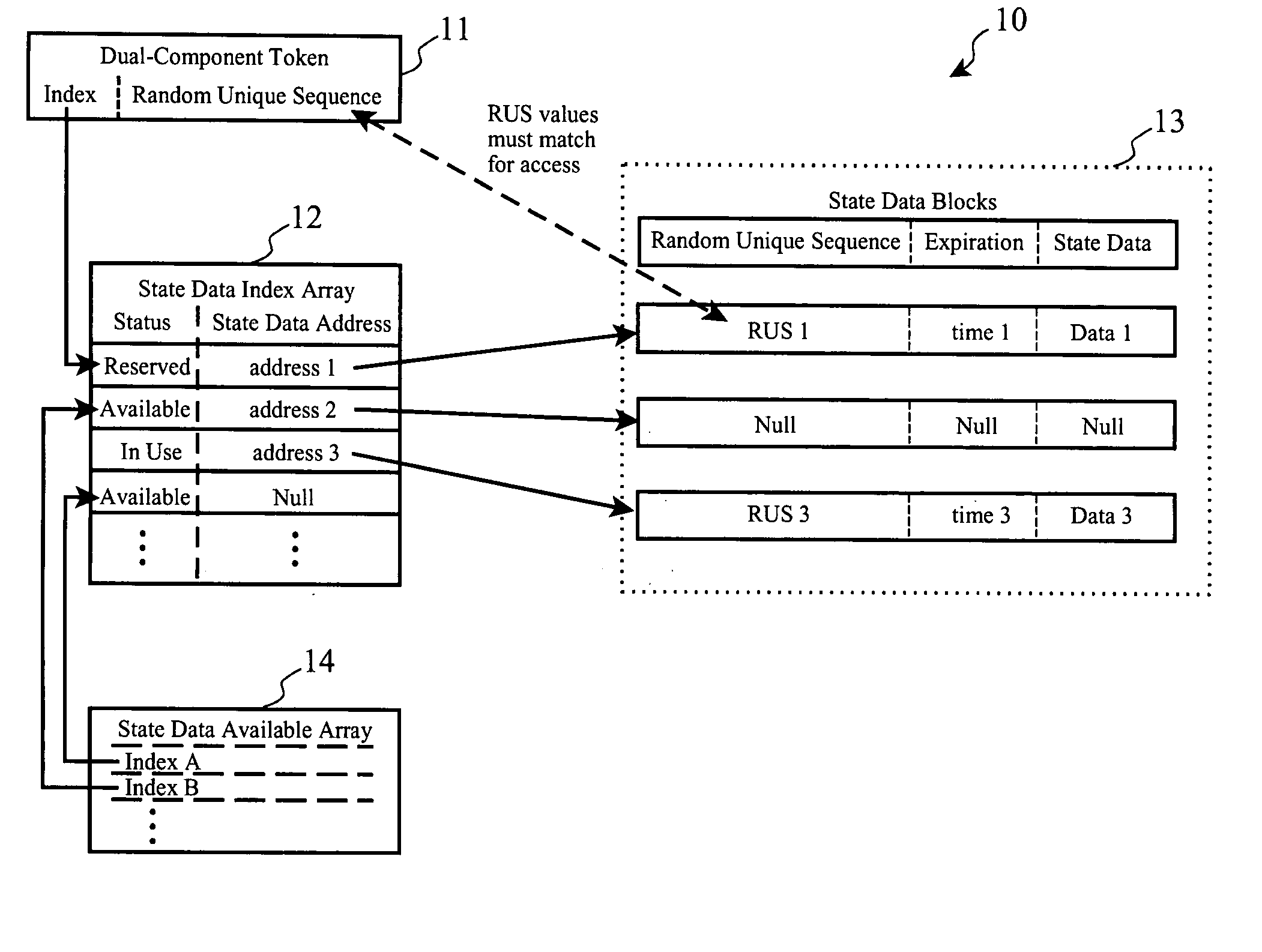

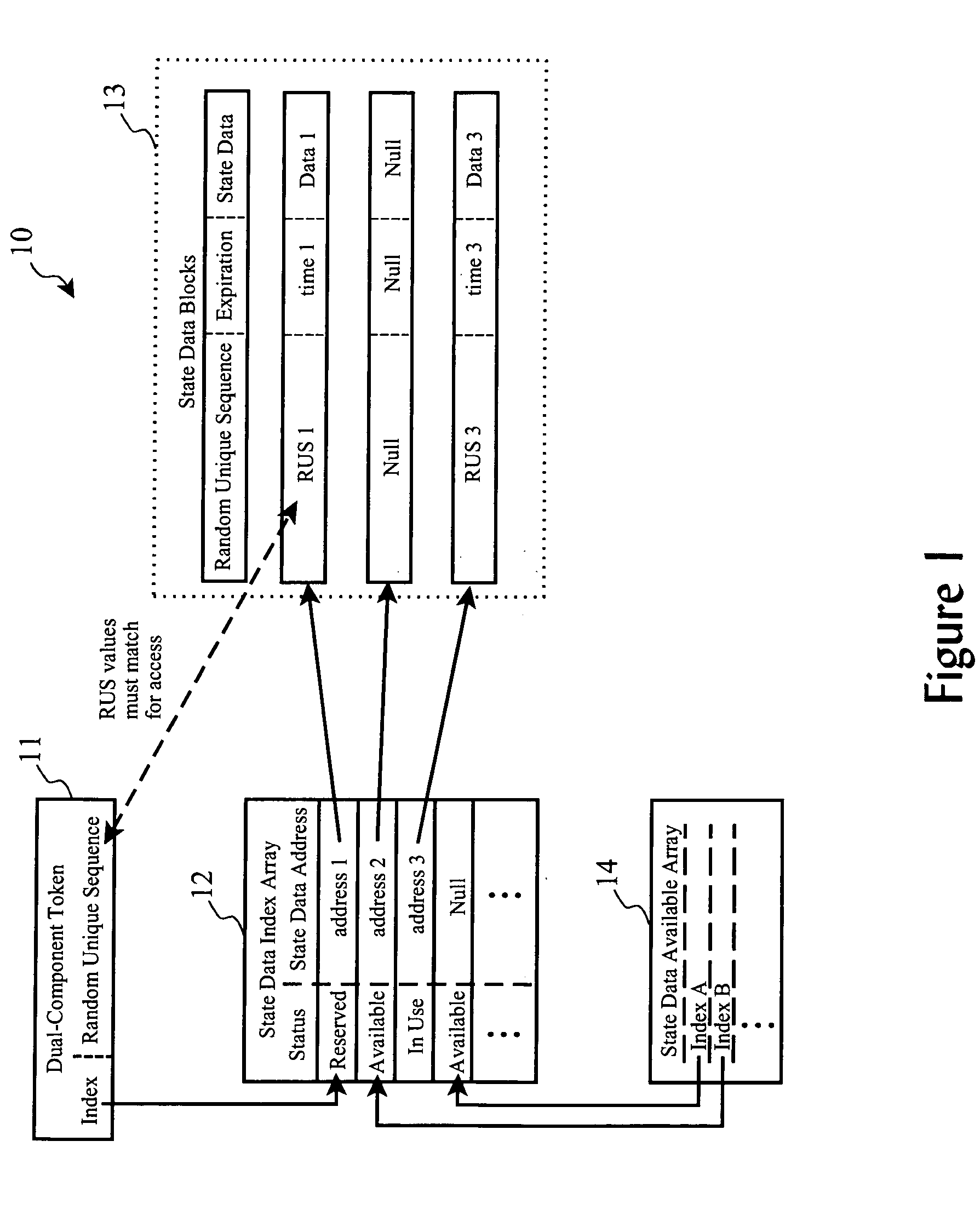

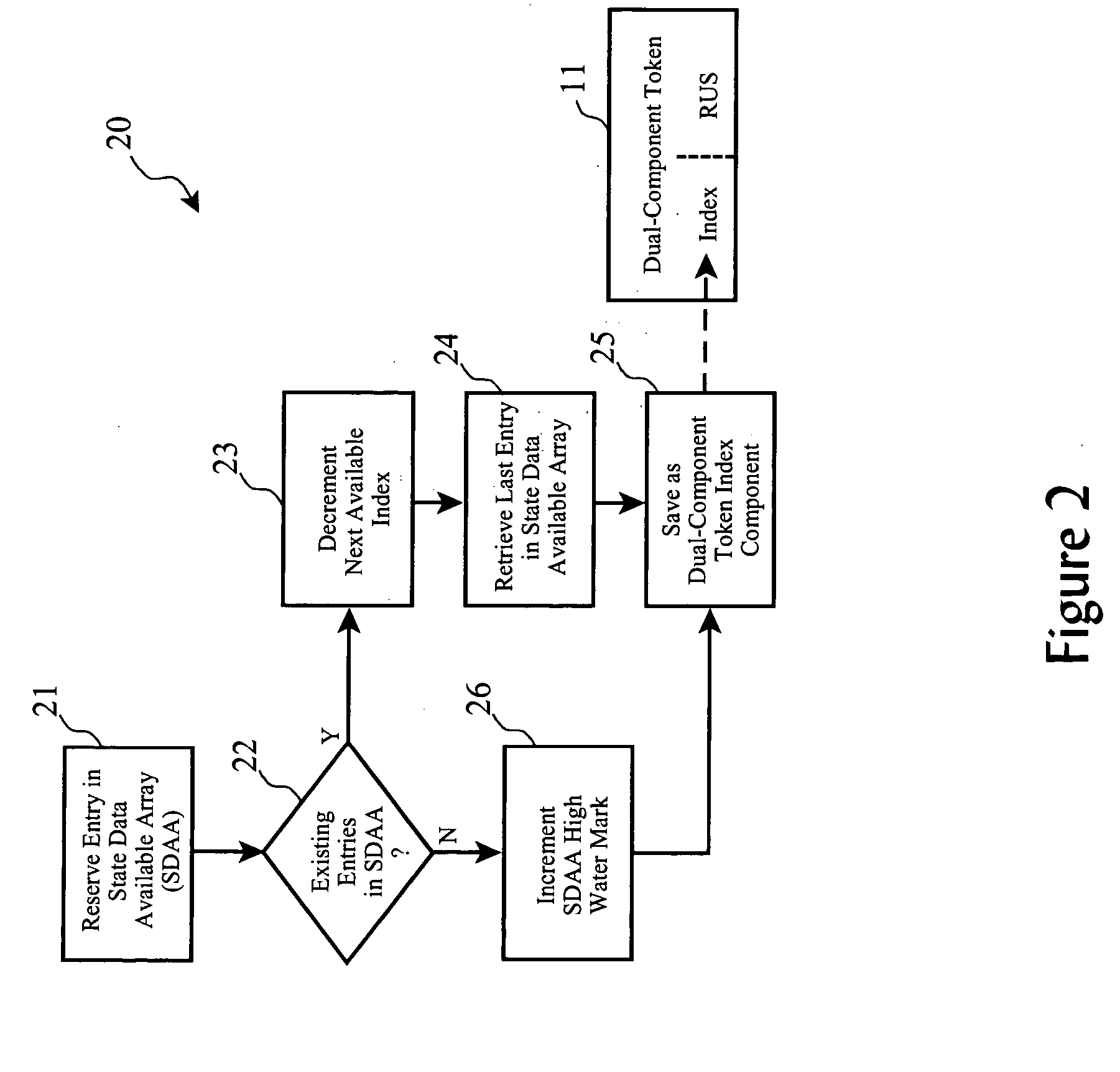

Dual-component state token with state data direct access index for systems with high transaction volume and high number of unexpired tokens

ActiveUS20050256822A1Avoid incorrect translationData processing applicationsDigital data information retrievalClient-sideOnline transaction processing

Access to state data by a client process such as state data in an Online Transaction Processing arrangement is controlled through generation of and exchanging of a dual-component token. The first component of the token is an Index value which indirectly points to a block of state data assigned to process or user. The second component of the token is a sequence value, such as a Random Unique Sequence value, which is also associated with the block of state data for a process. With each transaction request, a user process provides the token to the OLTP server, which then verifies the sequence numbers of the state data and the token match before allowing access to the data.

Owner:SAP AG

Systems and methods for transaction processing based upon an overdraft scenario

InactiveUS8190514B2Convenient transactionHand manipulated computer devicesFinanceTransaction processing systemAuthorization

Facilitating commercial transactions using a payment system directory are disclosed. A payment directory and / or wireless point of sale (POS) device may be configured to use predetermined rules, a multitude of data items and / or conditions to locate a payment system, and transmit a payment authorization request from a remote location to at least one payment system, either directly, or via a payment system directory and / or a SSL Gateway.

Owner:LIBERTY PEAK VENTURES LLC

Method and device for processing data in online business processing

InactiveCN101566986AReduce space consumptionReduce congestionSpecial data processing applicationsMaintainabilityOnline business

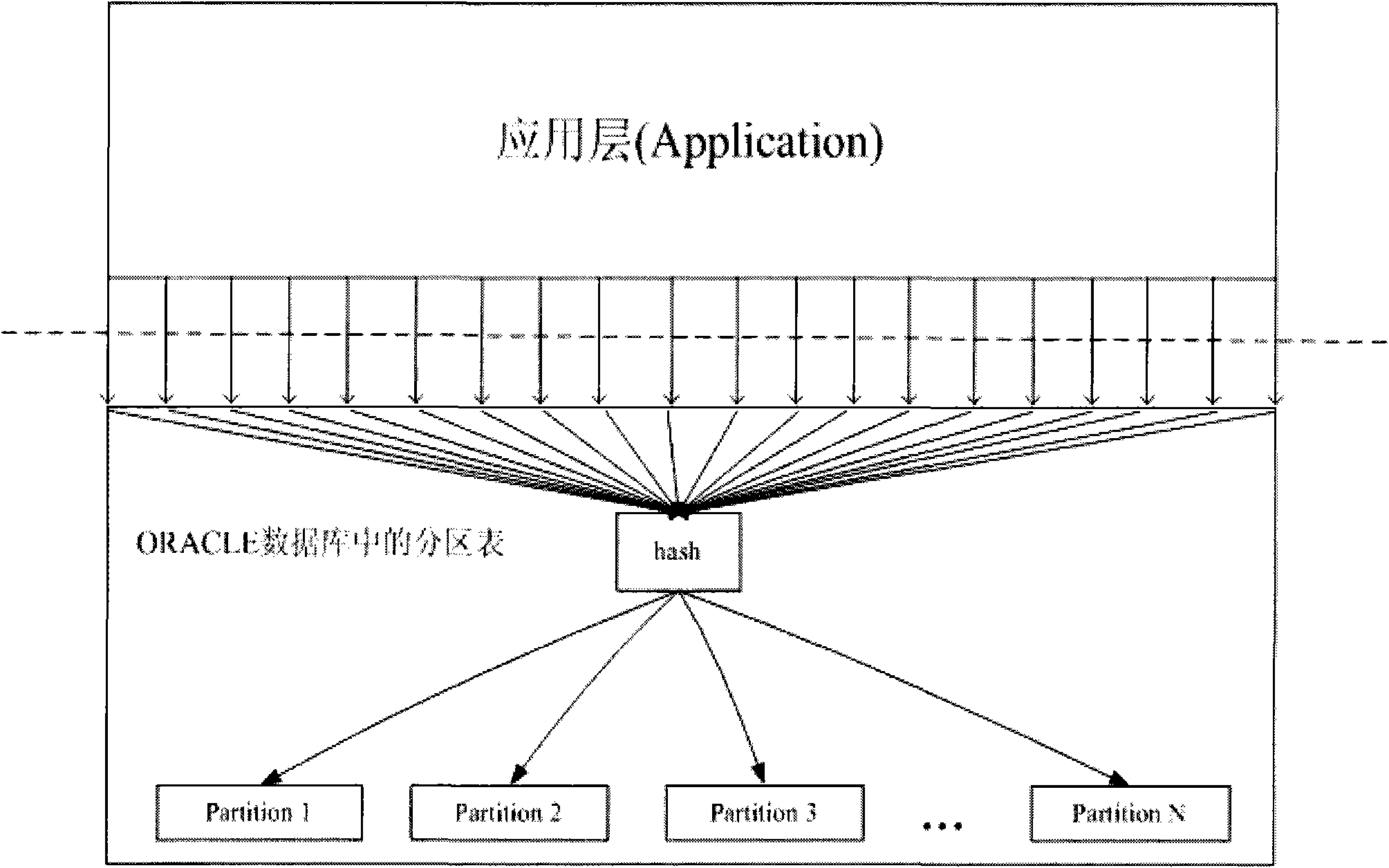

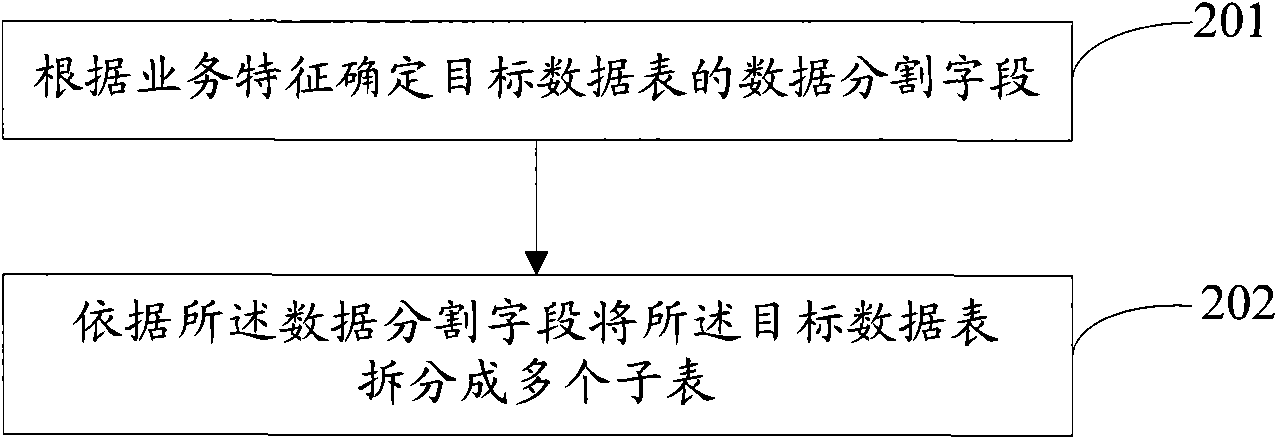

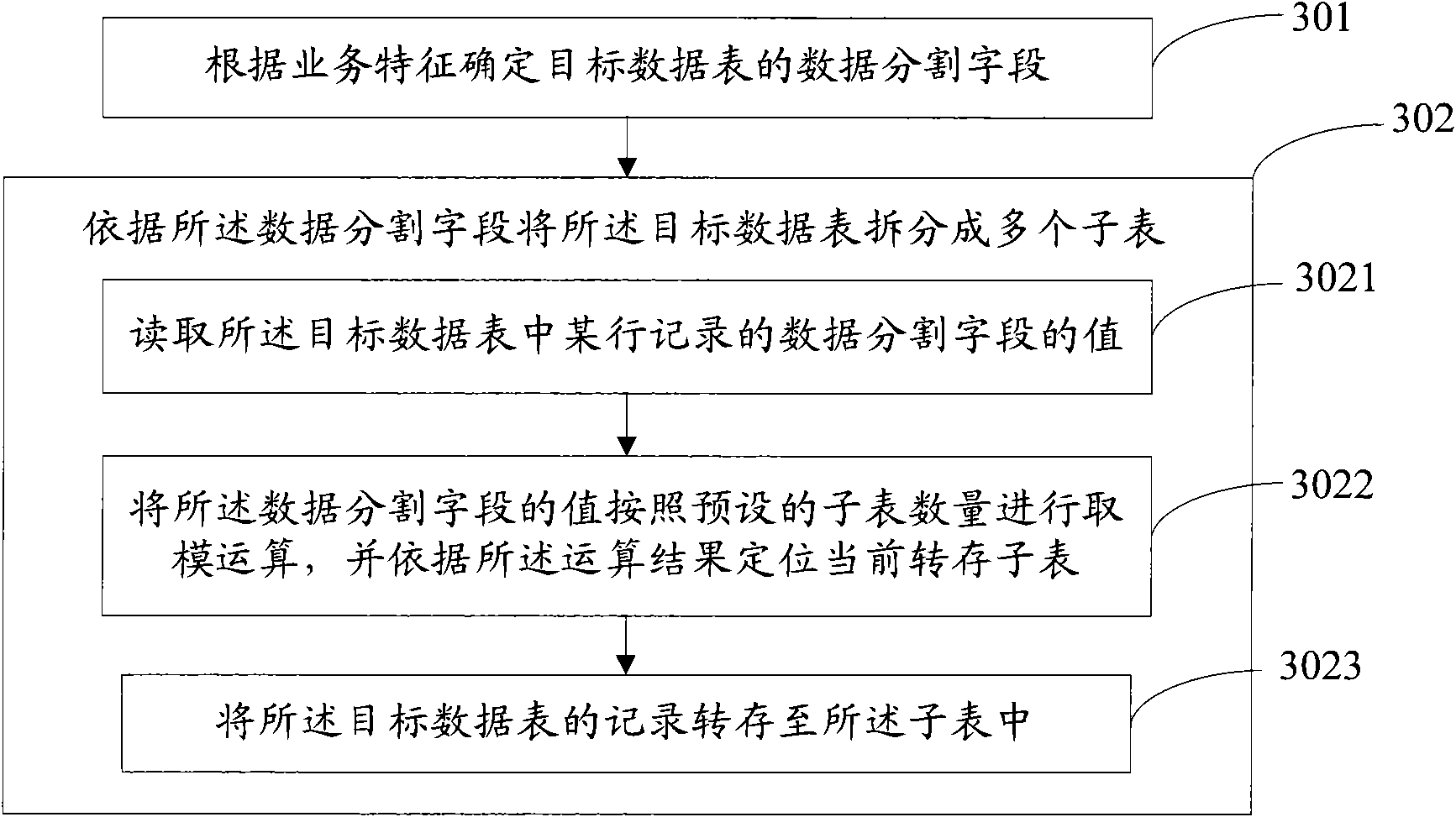

The invention discloses a method for processing data in online business processing, which comprises the following steps: a data partitioning field of a target data table is confirmed according to a business characteristic; and the target data table is divided into a plurality of subtables according to the data partitioning field. The invention uses the method that the core data table in an online business processing system is divided into a plurality of subtables to enable the data amount of the subtables after division to be lower than that of the original core data table. When DDL operation is carried out to the subtables, the occupied space of the temporary table is small, and blocked talks are few, thus the pressure born by the system is greatly reduced, and the maintainability and the manageability of the core data table of the database are improved.

Owner:ALIBABA GRP HLDG LTD

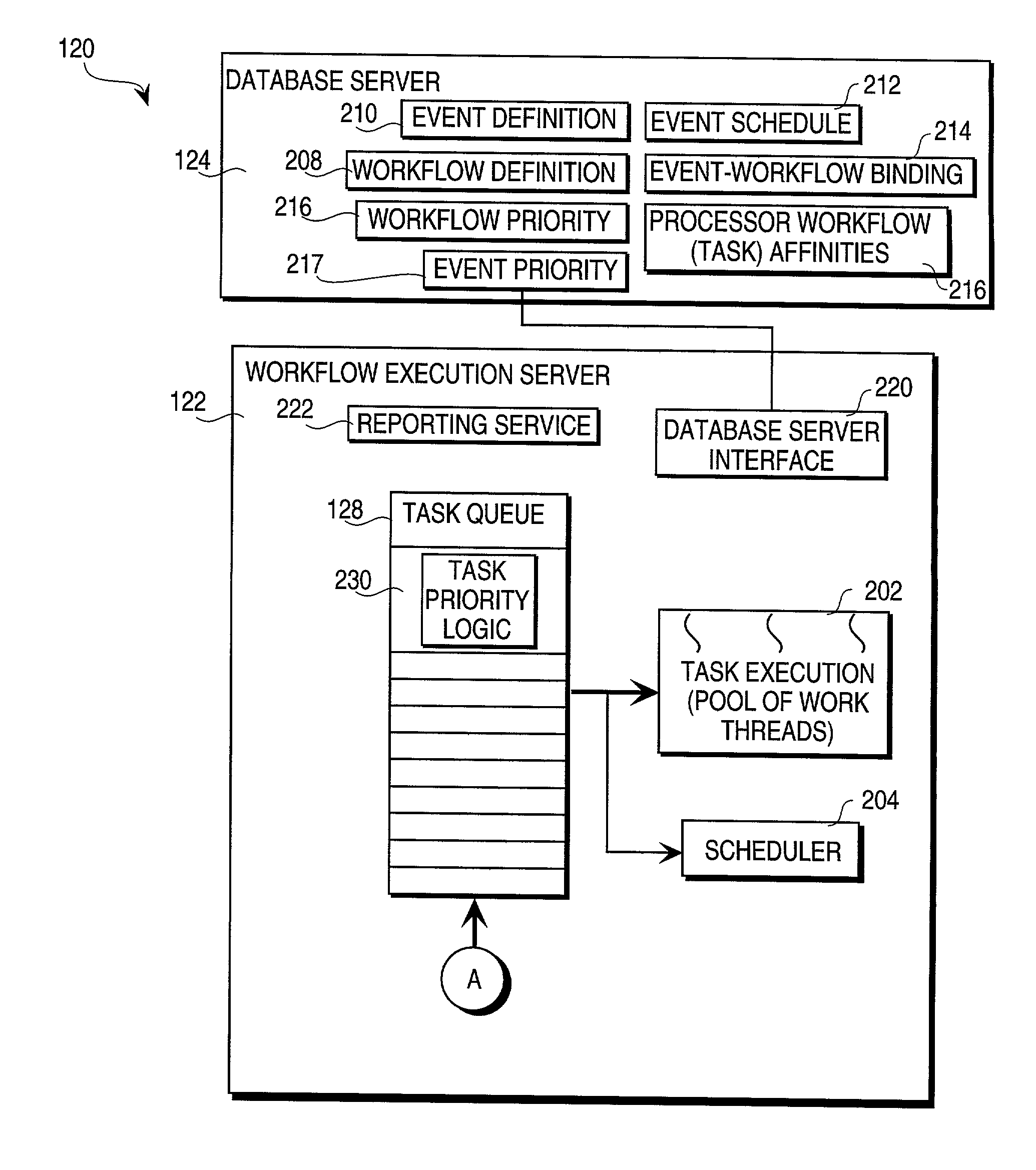

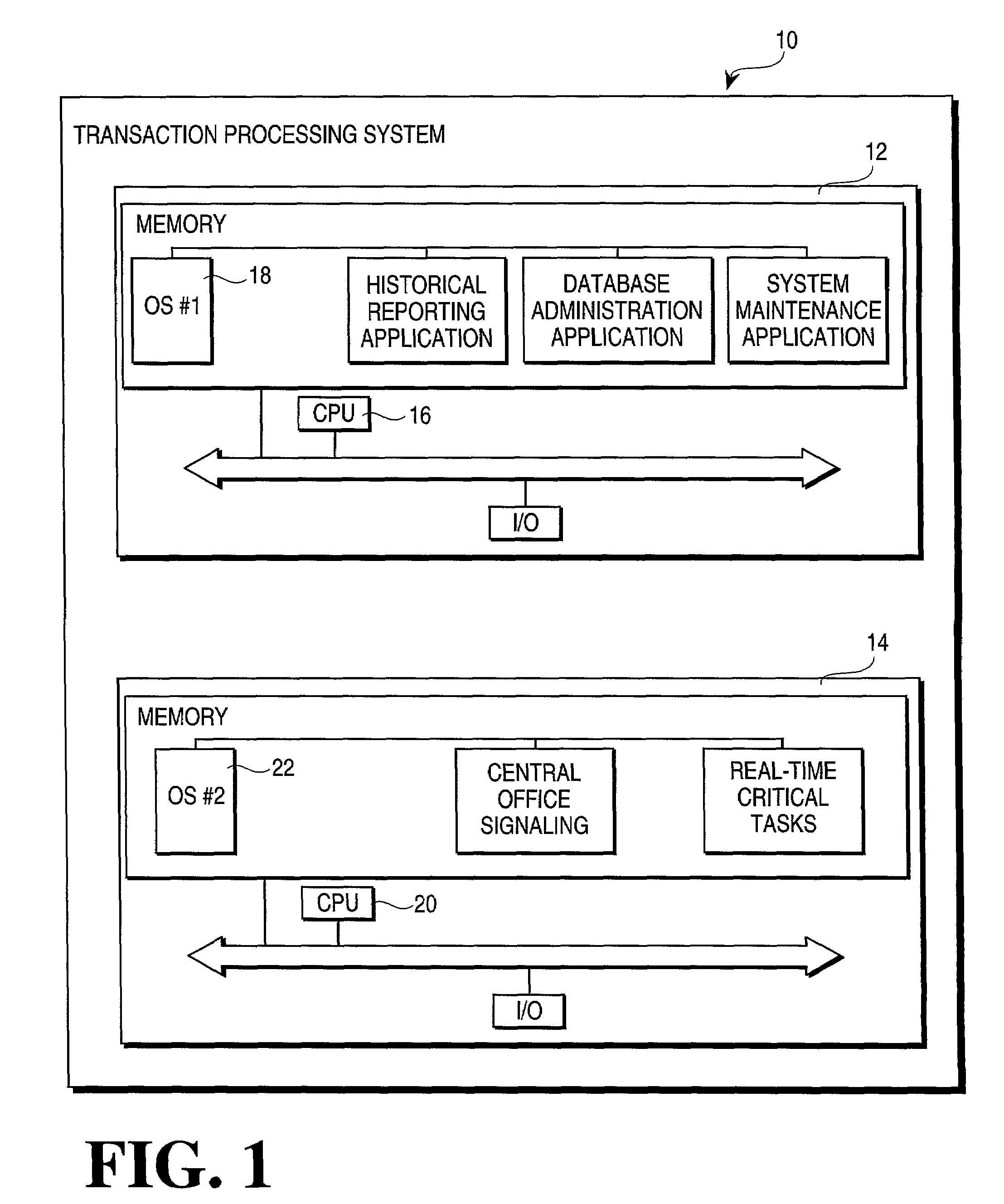

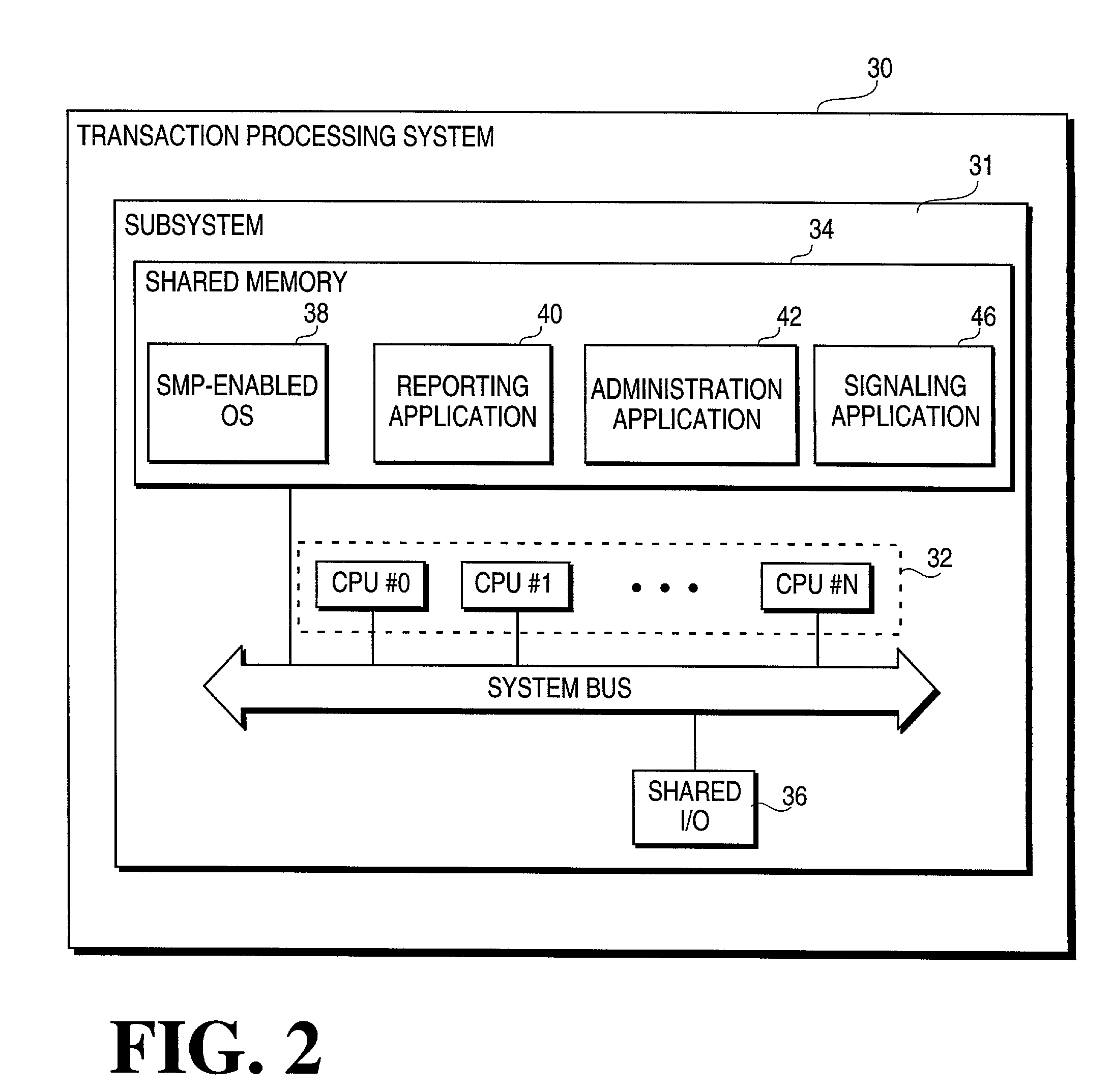

Methods and apparatus for executing a transaction task within a transaction processing system employing symmetric multiprocessors

InactiveUS7401112B1Multiprogramming arrangementsMultiple digital computer combinationsMulti processorTransaction processing system

A method of executing a transaction task within a transaction processing system includes, responsive to an event, the steps of identifying a workflow associated with the event. A transaction task, that at least partially executes the workflow, is distributed to an available thread within a pool threads operating within a multiprocessor system, that may be a Symmetrical Multiprocessor (SMP) system.

Owner:ASPECT COMM +1

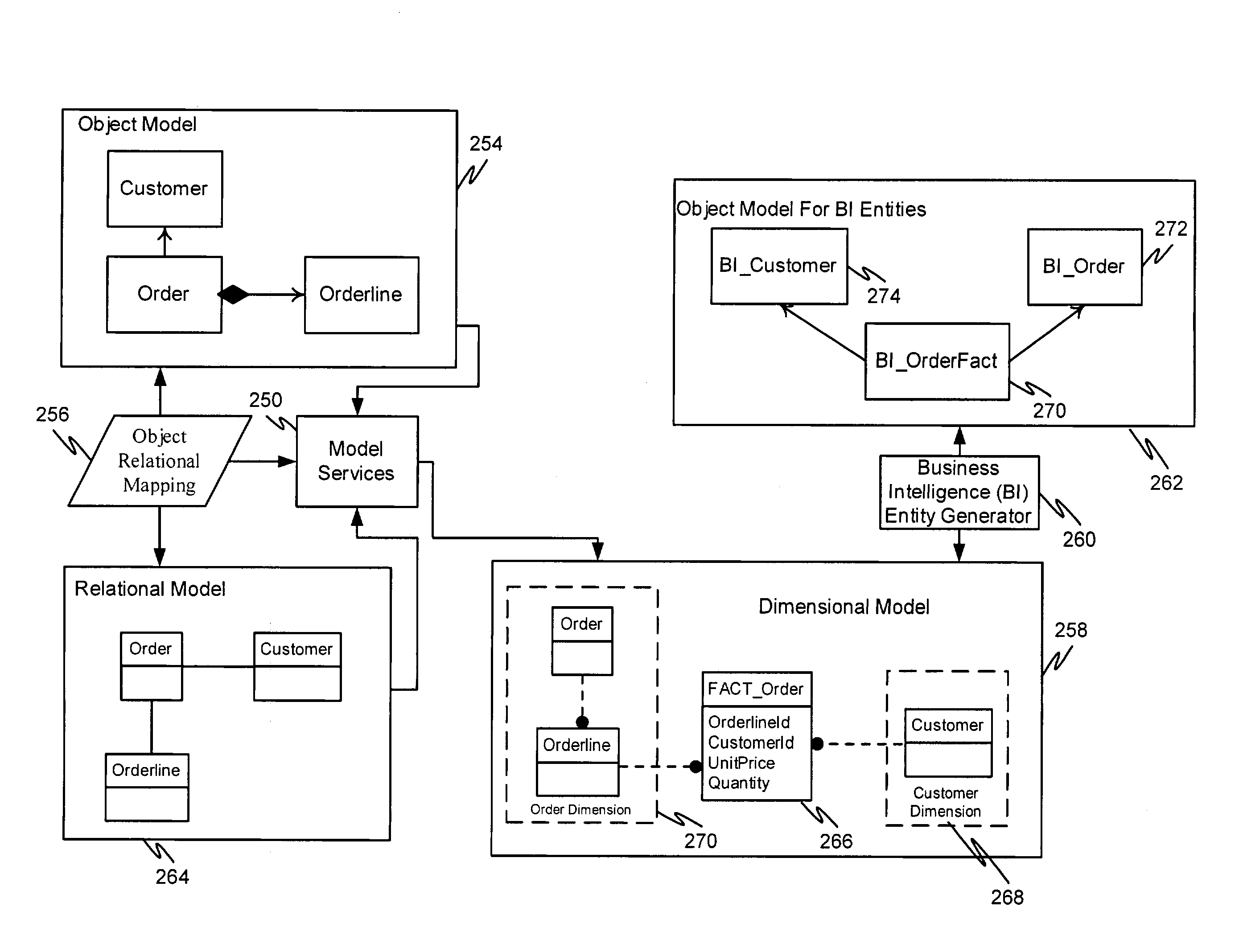

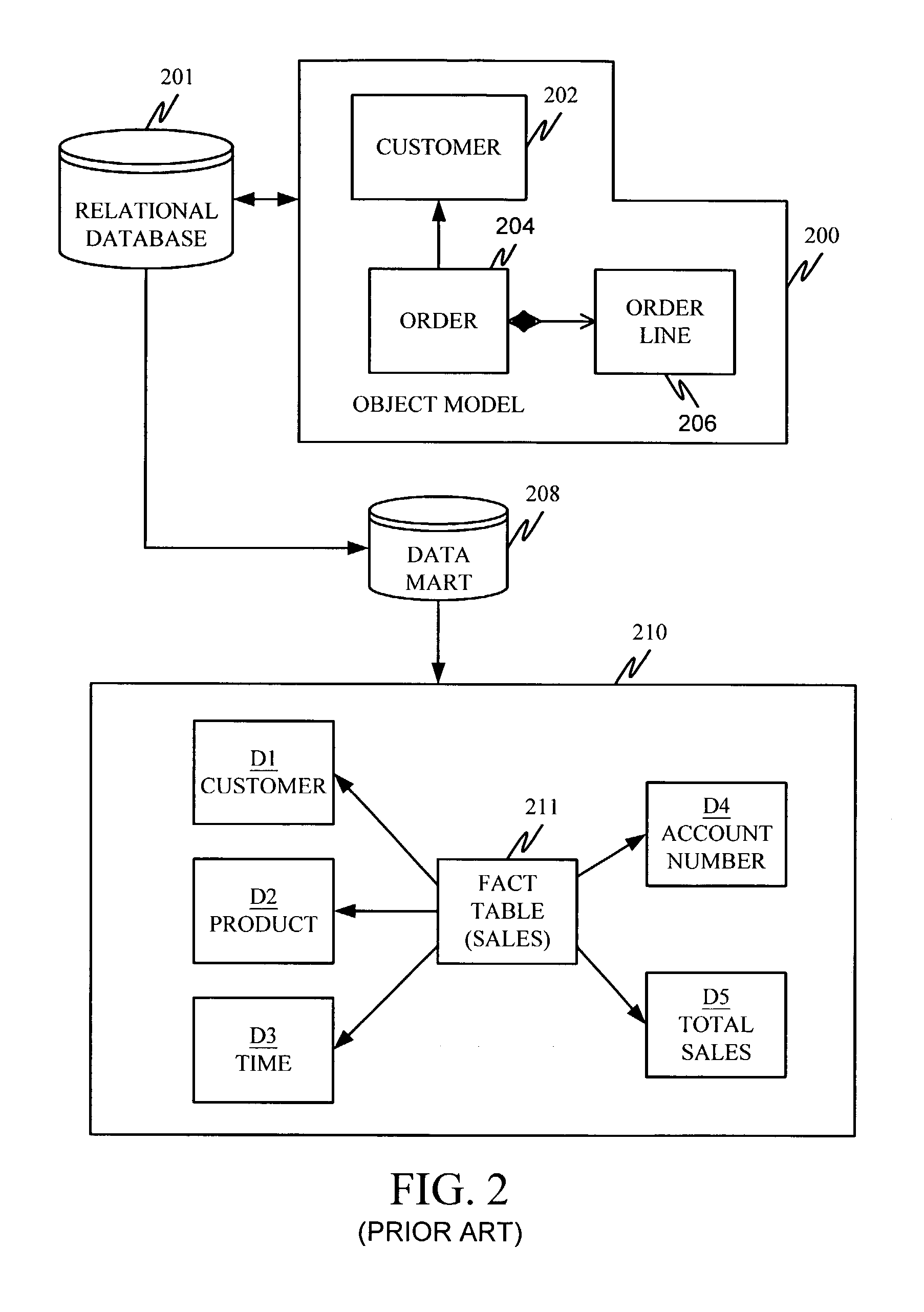

Automatic generation of a dimensional model for business analytics from an object model for online transaction processing

InactiveUS7275024B2FinanceAnalogue computers for electric apparatusDatabaseOnline transaction processing

The present invention automatically generates a dimensional model from an object model. The relationships in the object model are used to infer foreign key relationships in the dimensional model.

Owner:SERVICENOW INC

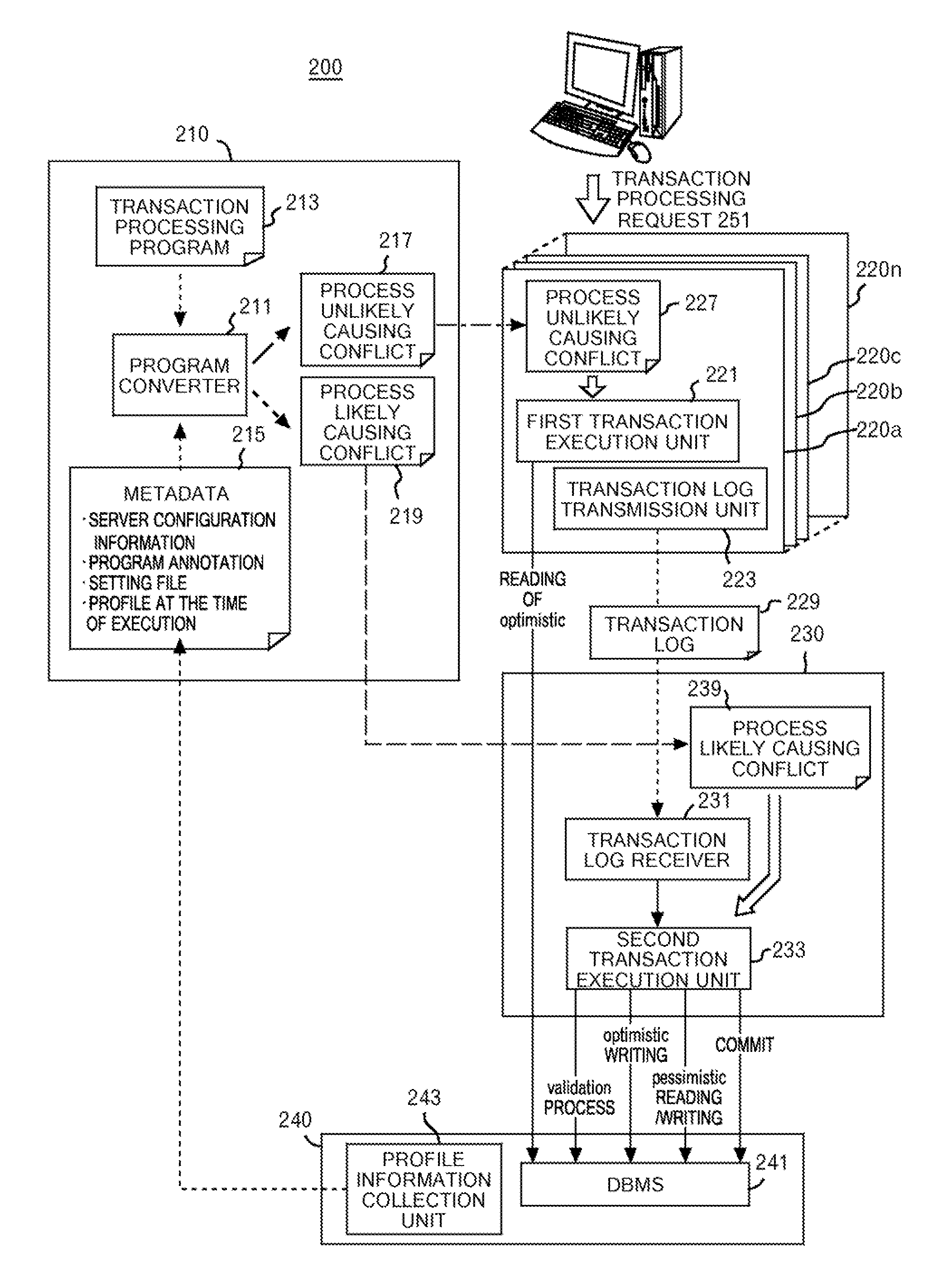

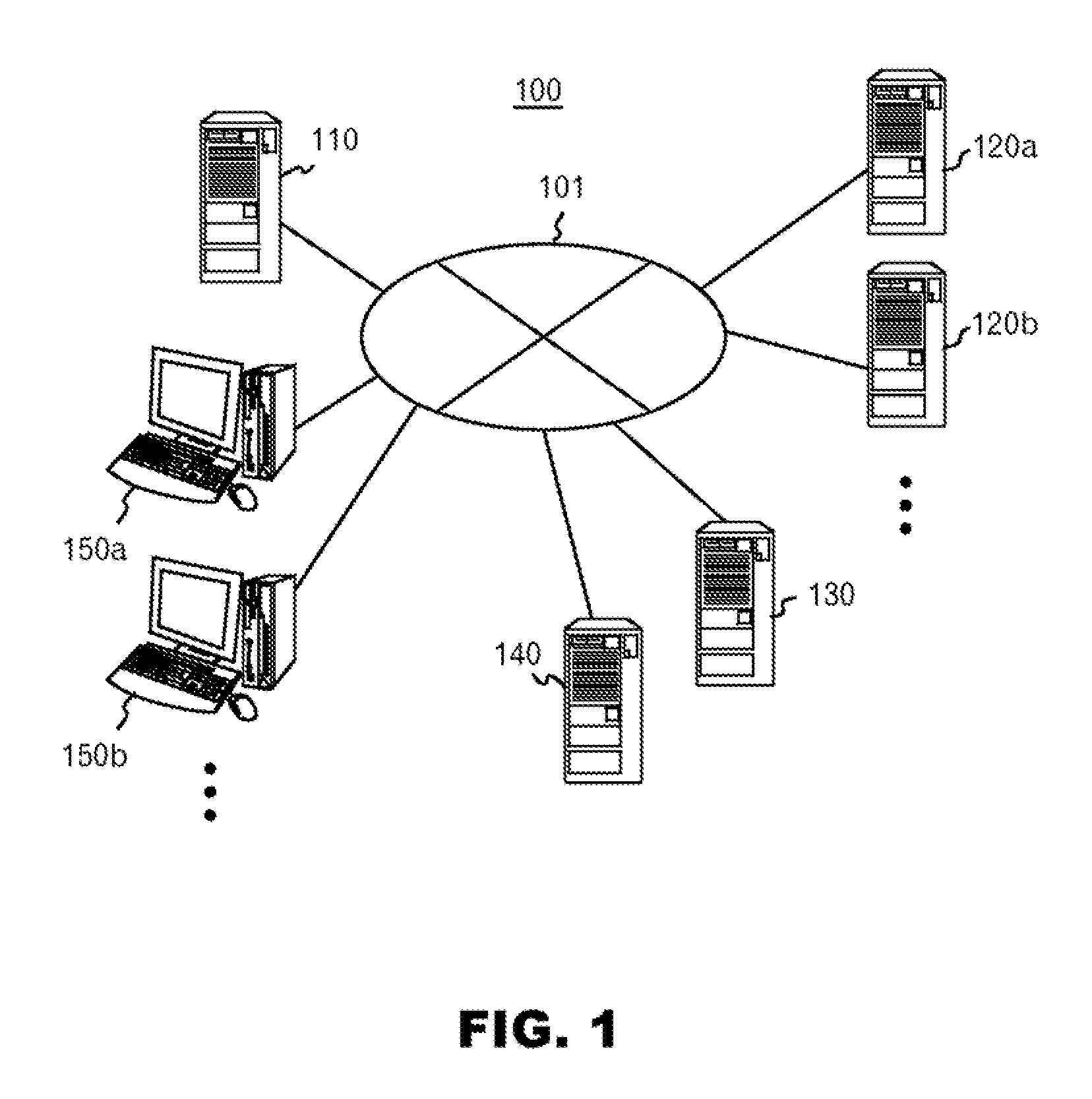

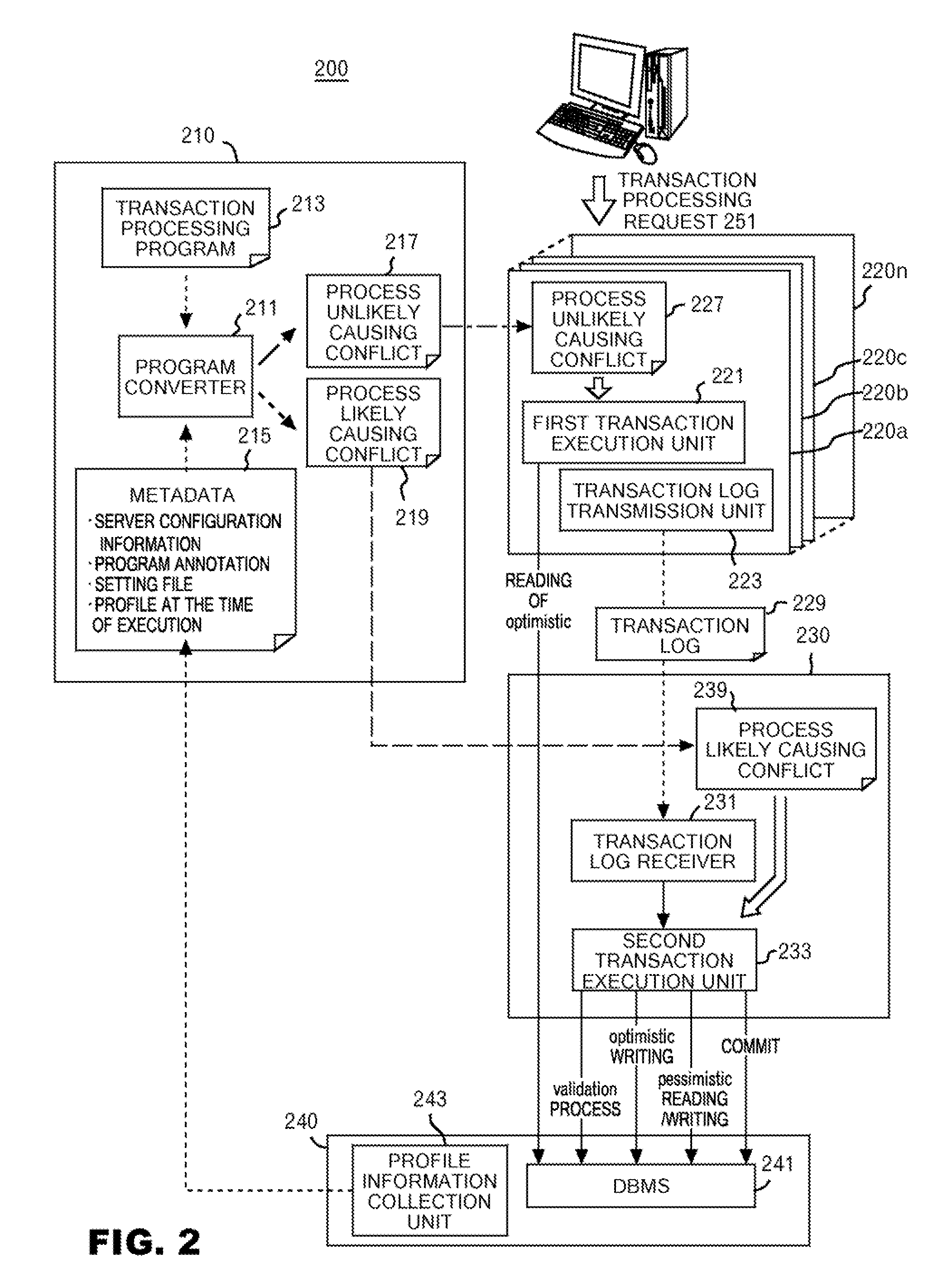

Method and system for dividing and executing on-line transaction processing in distributed environment

InactiveUS8276153B2Digital data processing detailsSpecial data processing applicationsTransaction logExecution unit

A method, system and computer program capable of executing a transaction in a scalable manner by dividing and then executing the transaction in a distributed environment. In an embodiment of the invention, a system divides and then executes a transaction in a distributed environment. The system includes means which divides the transaction processing into an optimistic process which unlikely causes conflicts and a pessimistic process which likely causes conflicts; a first server; and a second server. The first server includes a first transaction execution unit for executing the optimistic process; and a transaction log transmission unit for transmitting a result of the execution of the optimistic process to the second server. The second server includes a transaction log receiving unit for receiving the transmission log; and a second transaction execution unit for executing the pessimistic process.

Owner:IBM CORP

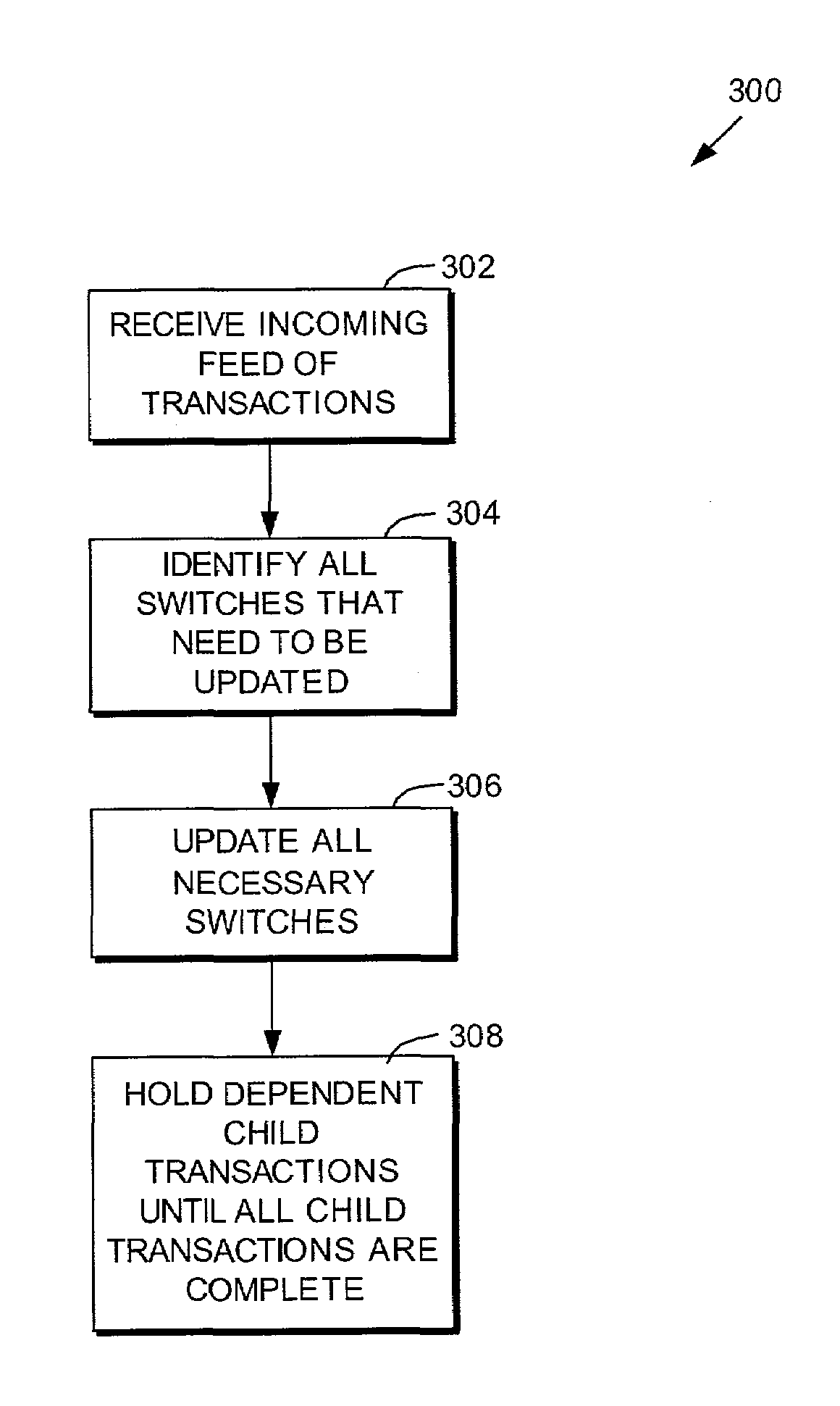

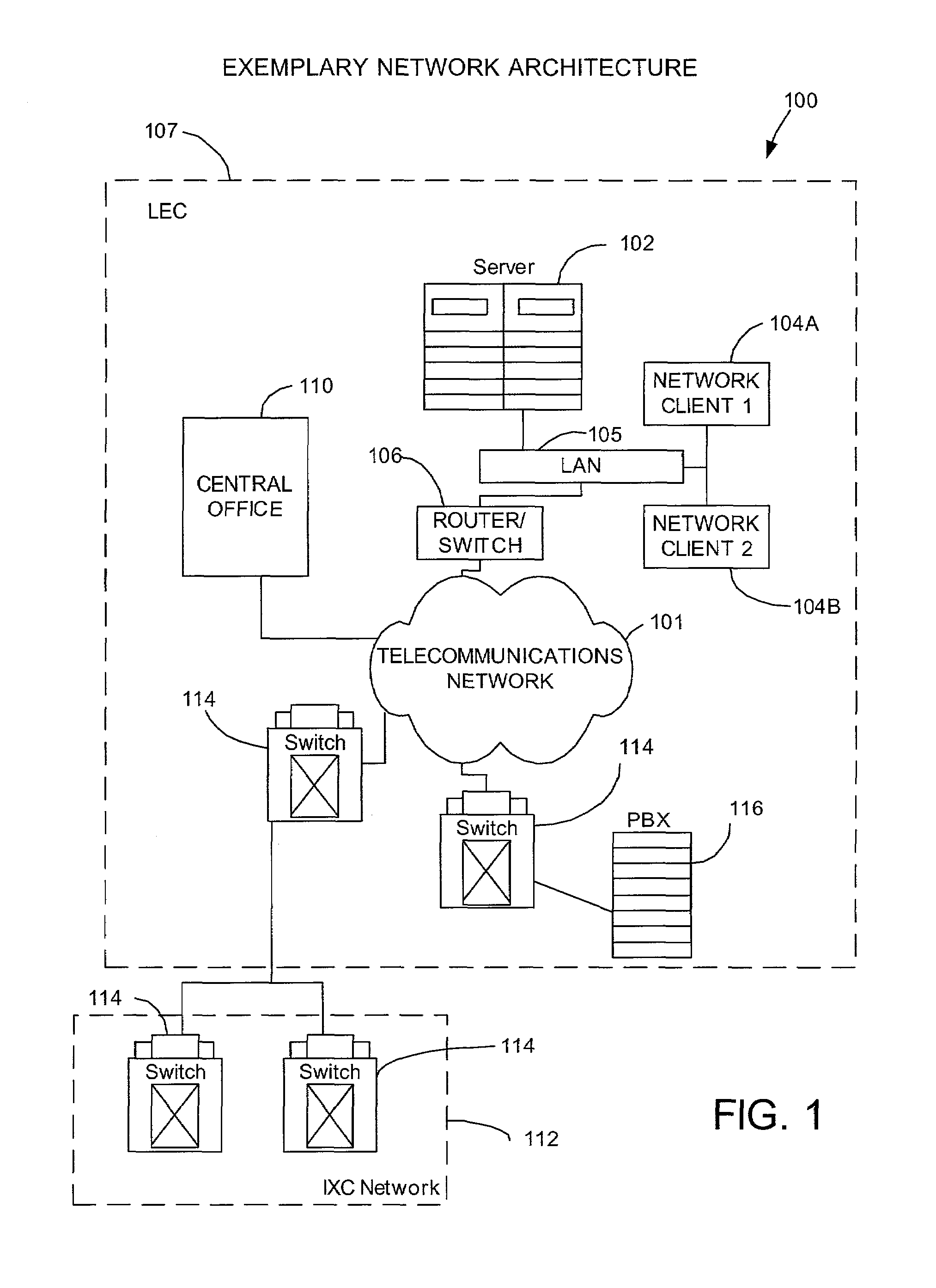

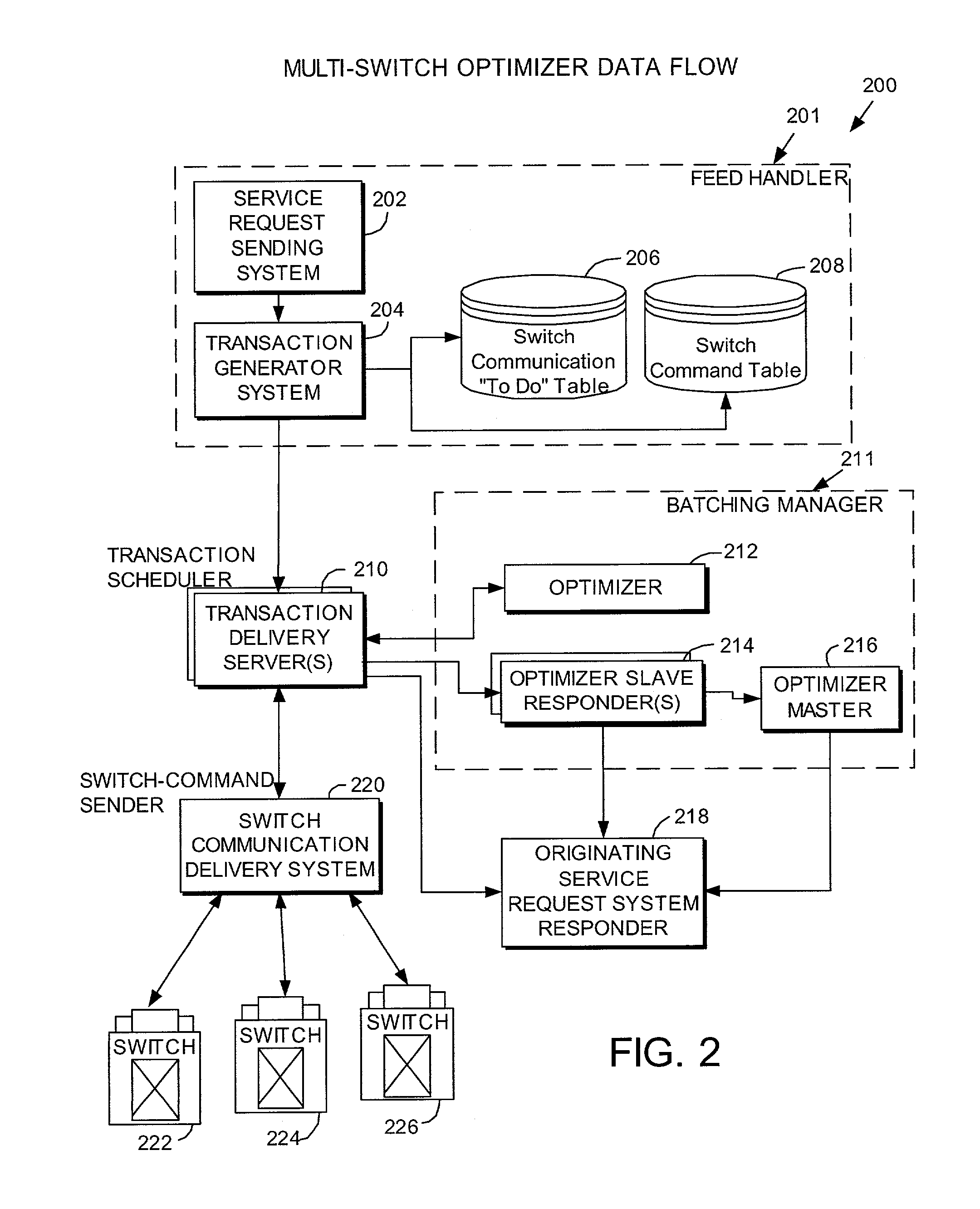

Method and system for optimizing switch-transaction processing in a telecommunications network

ActiveUS7184439B1Efficient processingShorten the timeError preventionTransmission systemsTelecommunications linkTelecommunications network

A method, system and article for optimizing the processing of switch transactions and updating multiple switches of a communications network based on a single transaction is provided. When a switch is backlogged with transactions beyond a threshold quantity, those transactions heading to the backlogged switch are grouped together, placed in a file and sent to the switch as a single transaction. Some of the batched individual transactions may be dependent upon other switches as well. The present invention accommodates for multiple dependencies and responds with a success notification only when all portions of the original transaction are complete. In another aspect of the invention, where multiple switches require updating, such updating can be accomplished with only a single transaction. Switch identification information is included with the transaction permitting multiple switches to be updated from the single transaction.

Owner:T MOBILE INNOVATIONS LLC

Transaction processing system providing improved methodology for two-phase commit decision

InactiveUS6799188B2Improve performanceImprove system performanceData processing applicationsMultiple digital computer combinationsImproved methodTransaction processing system

A transaction processing system providing improved methodology for invoking two-phase commit protocol (2PC) is described. More particularly, a transaction is handled without use of 2PC until the system determines that the transaction does, in fact, involve changes to more than one database. The methodology improves overall system performance by looking at each transaction to determine whether the transaction actually requires use of 2PC before incurring the overhead associated with use of the two-phase commit protocol. Because only a small percentage of real world transactions result in updates to more than one database, the methodology improves the overall performance of transaction processing systems considerably.

Owner:BORLAND

Method and System for Providing Risk Information in Connection with Transaction Processing

A system for providing real-time risk mitigation for an authorization system. The system receives authorization requests from multiple merchants (or their respective acquirers) and processes such requests. Each processed request is then forwarded to its corresponding issuer for further authorization. Each processed request includes an authorization message. The authorization message can include a risk score, a number of reason codes, and a number of condition codes. The use of the risk score, reason codes and condition codes allows issuers to make better informed decisions with respect to providing authorizations.

Owner:VISA USA INC (US)

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com