Patents

Literature

95 results about "Bank Account Number" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

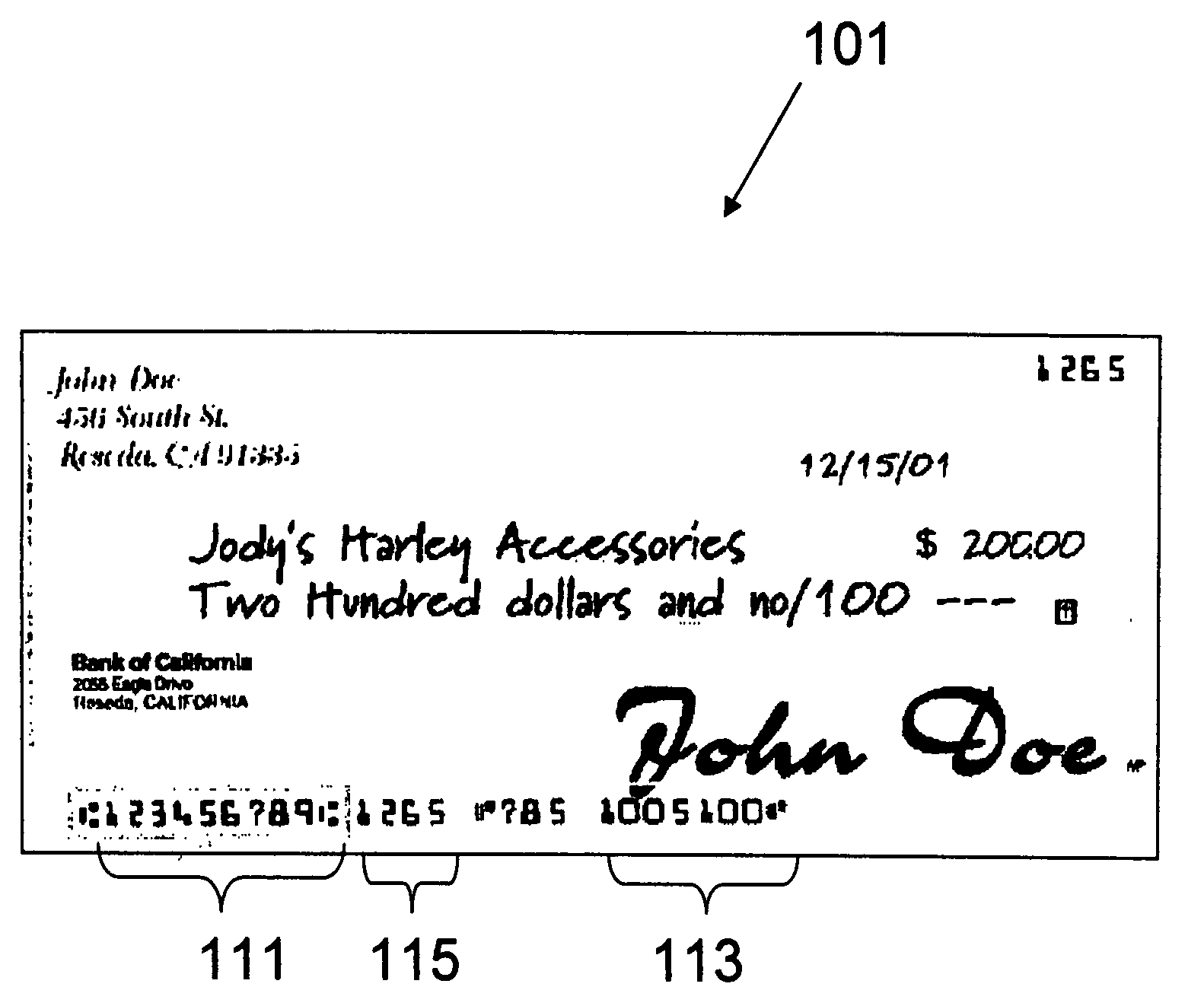

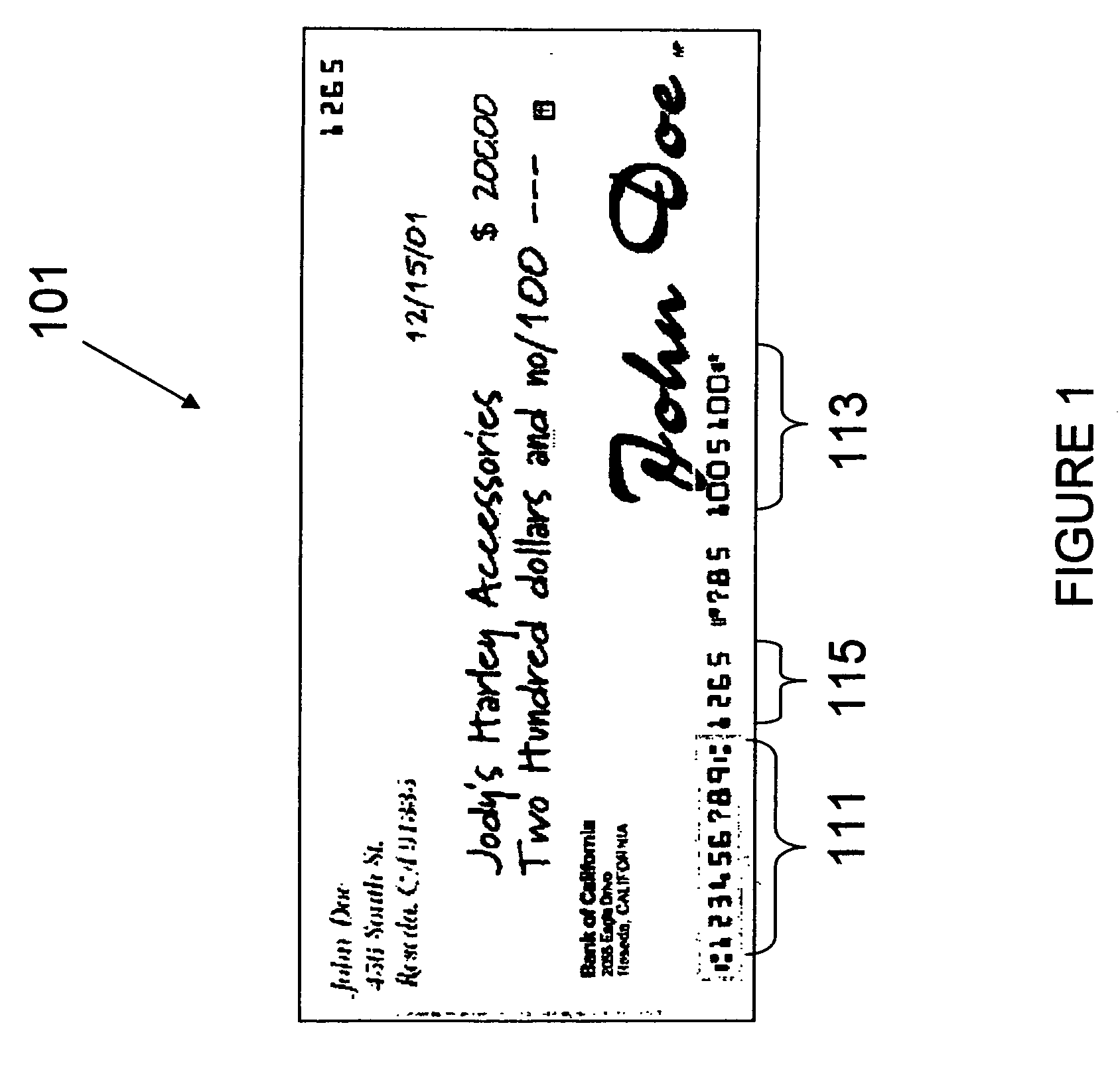

The bank account number is located at the bottom of the check, immediately following the routing number, which identifies the bank within the financial system.

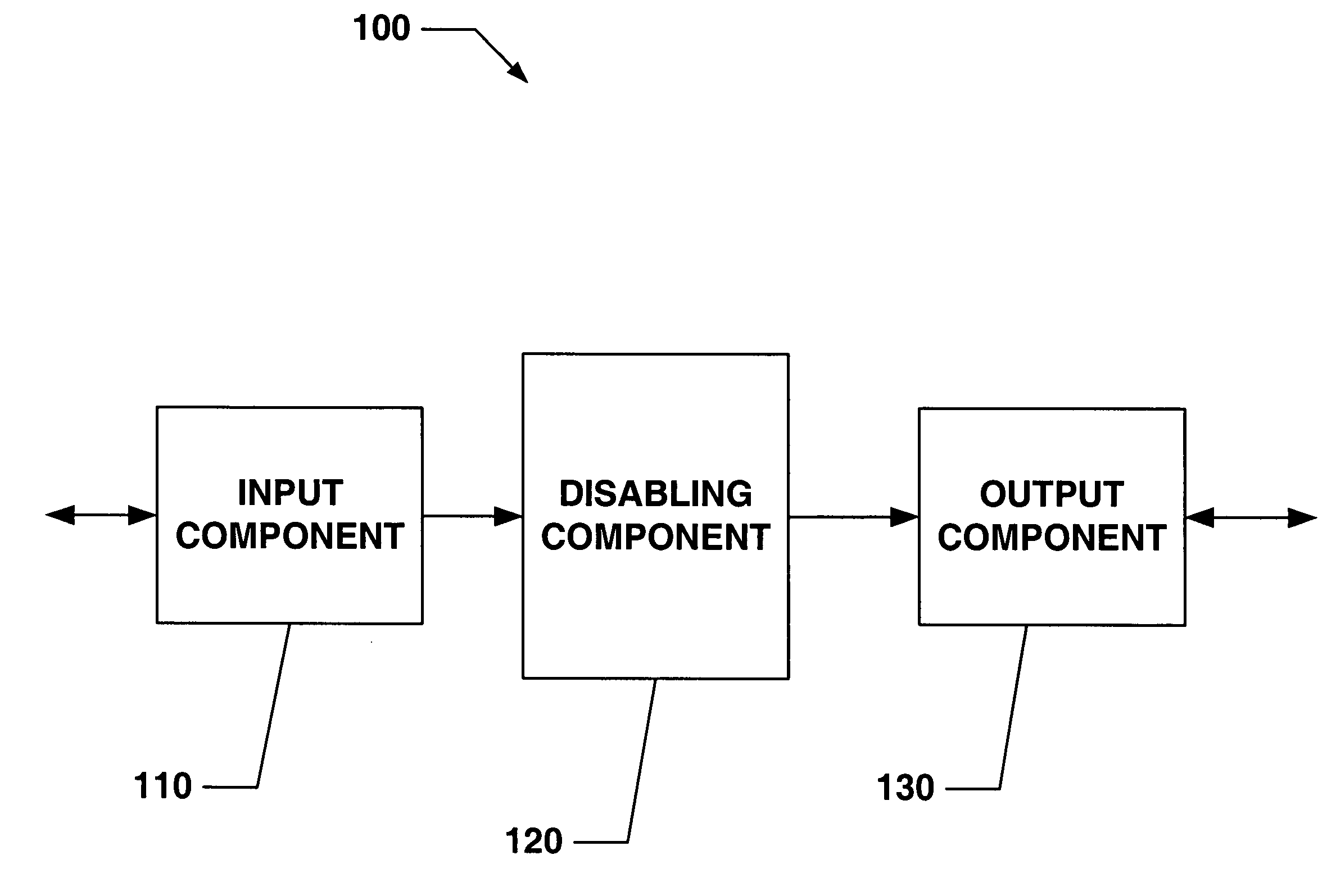

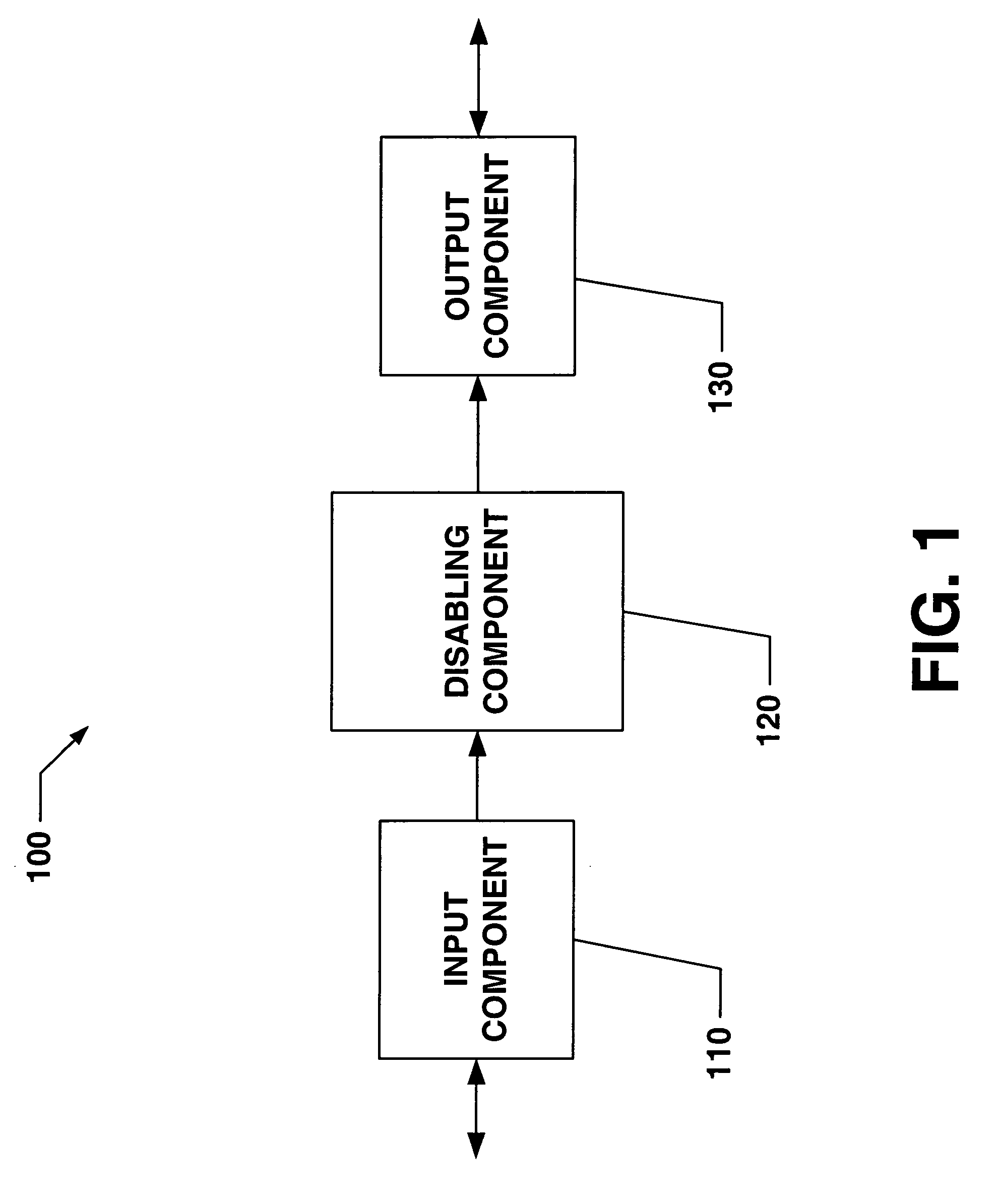

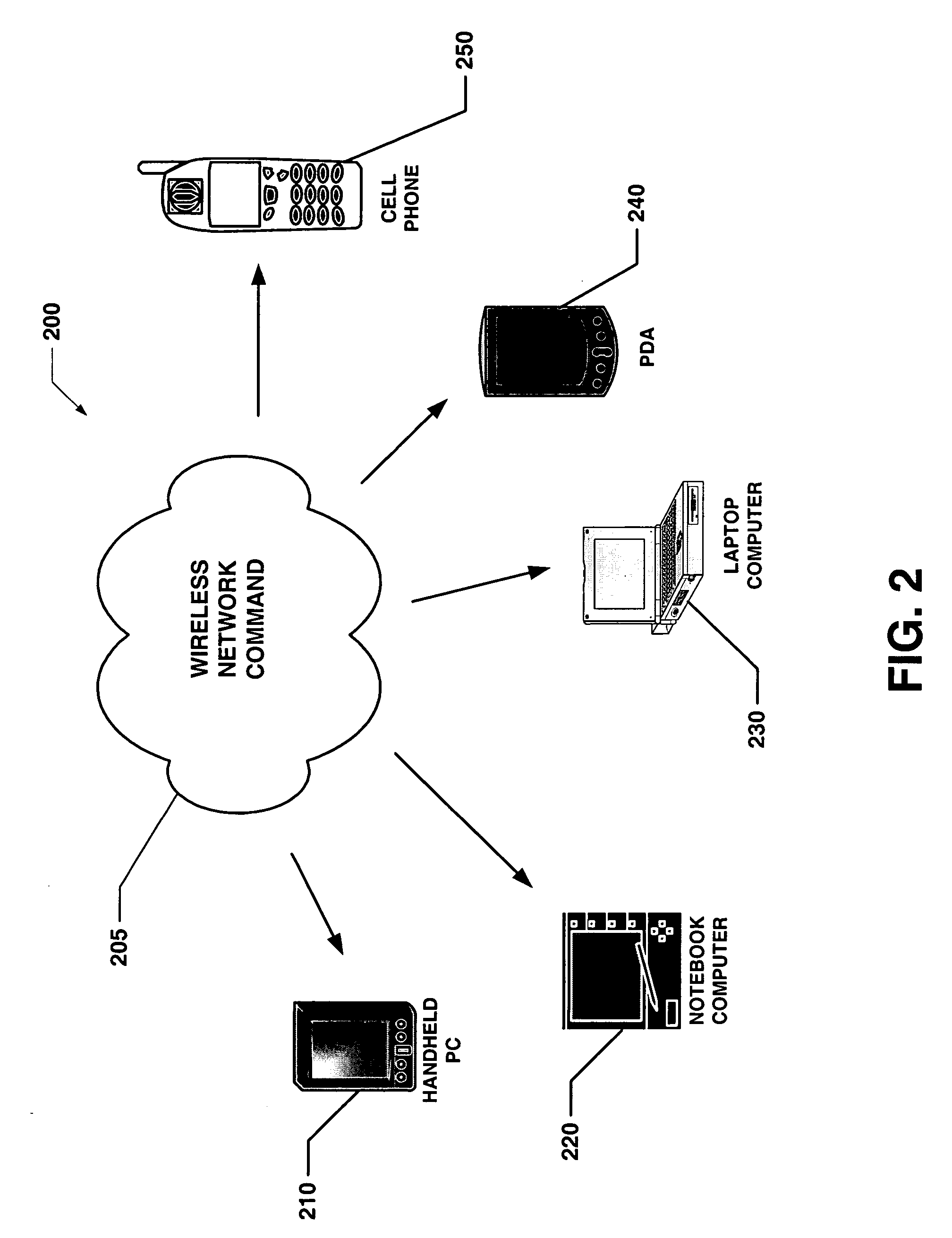

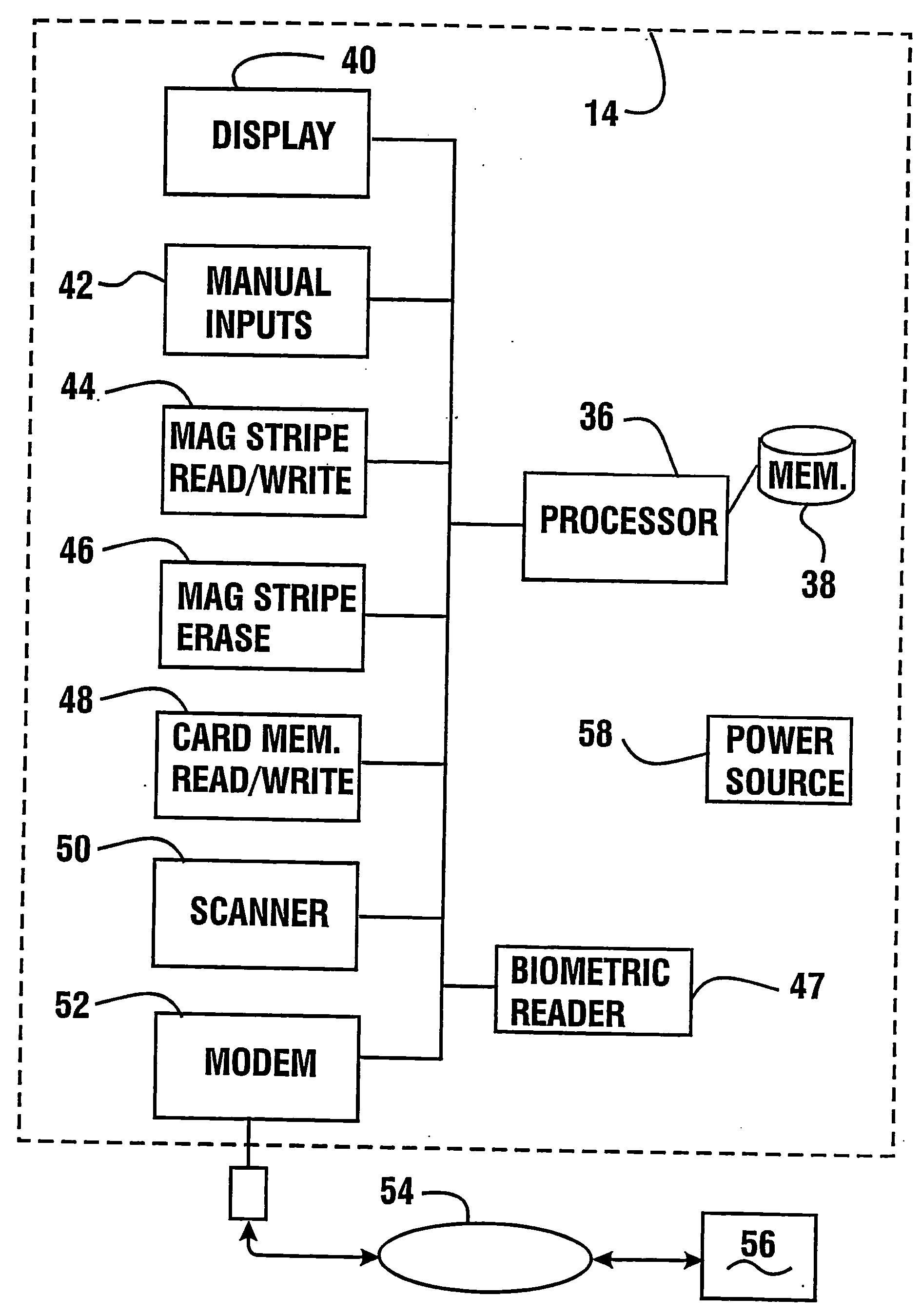

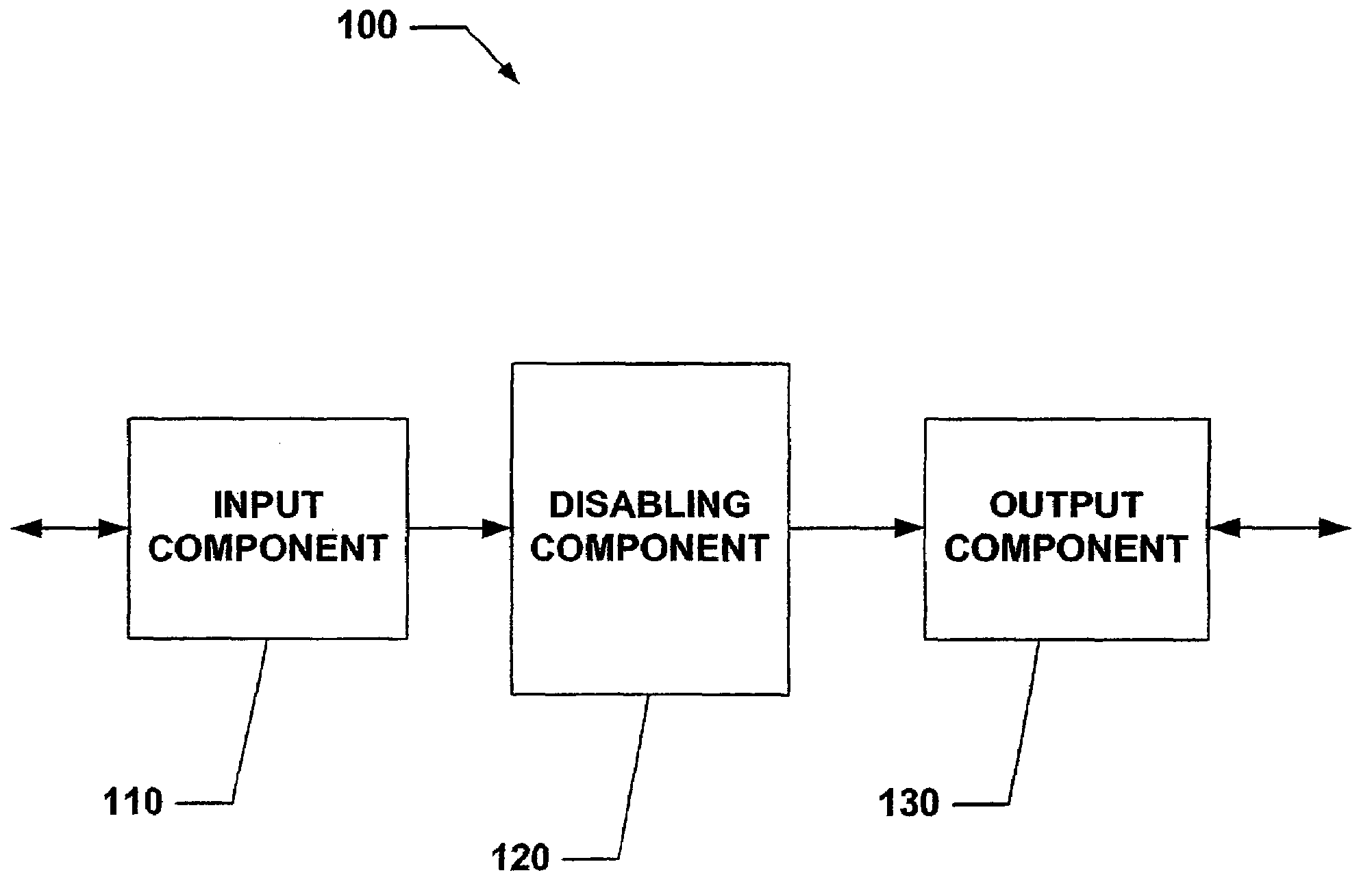

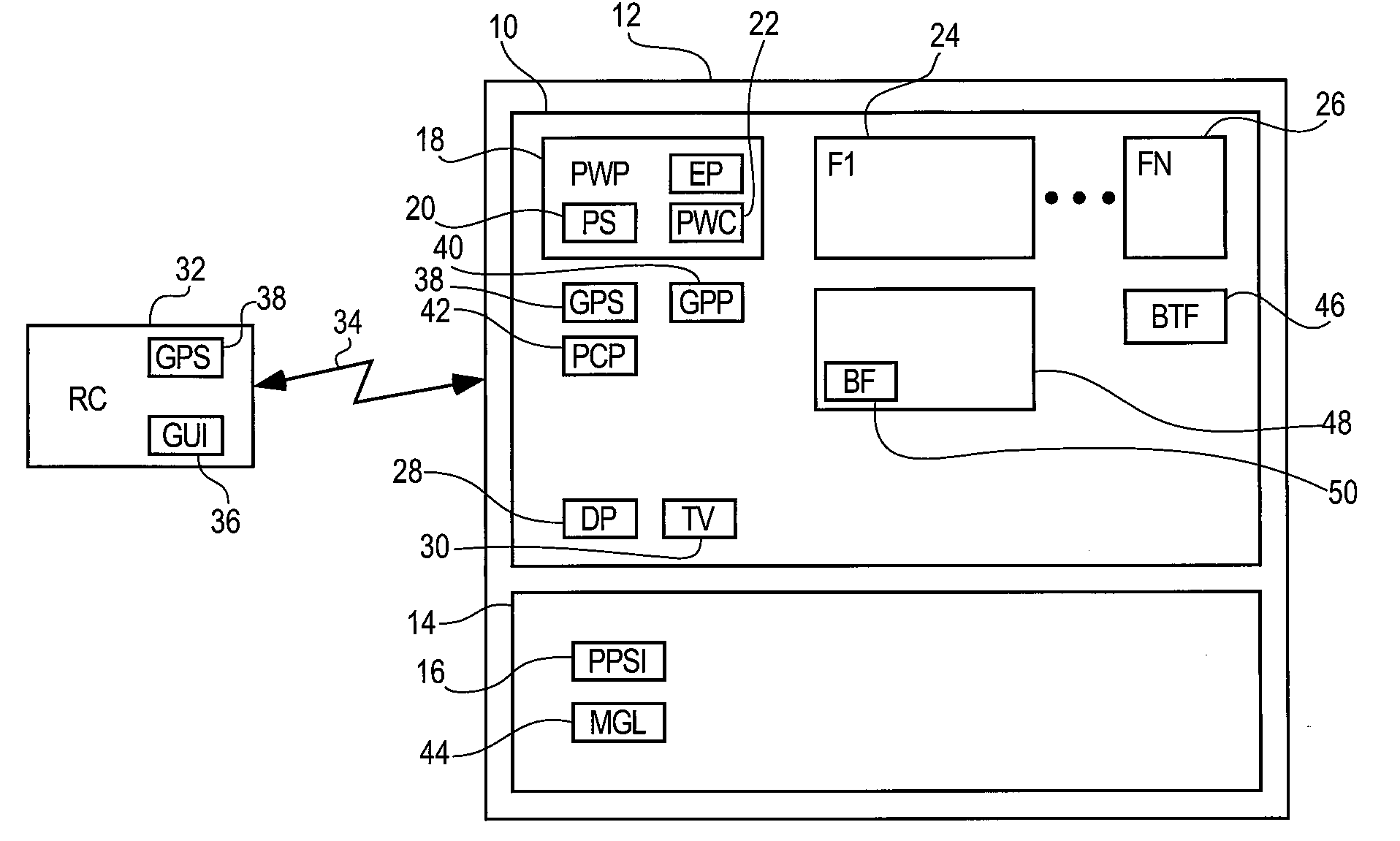

Systems and methods that provide user and/or network personal data disabling commands for mobile devices

InactiveUS20050186954A1Reduce harmPrevent unauthorized accessUnauthorised/fraudulent call preventionUnauthorized memory use protectionCredit cardInternet privacy

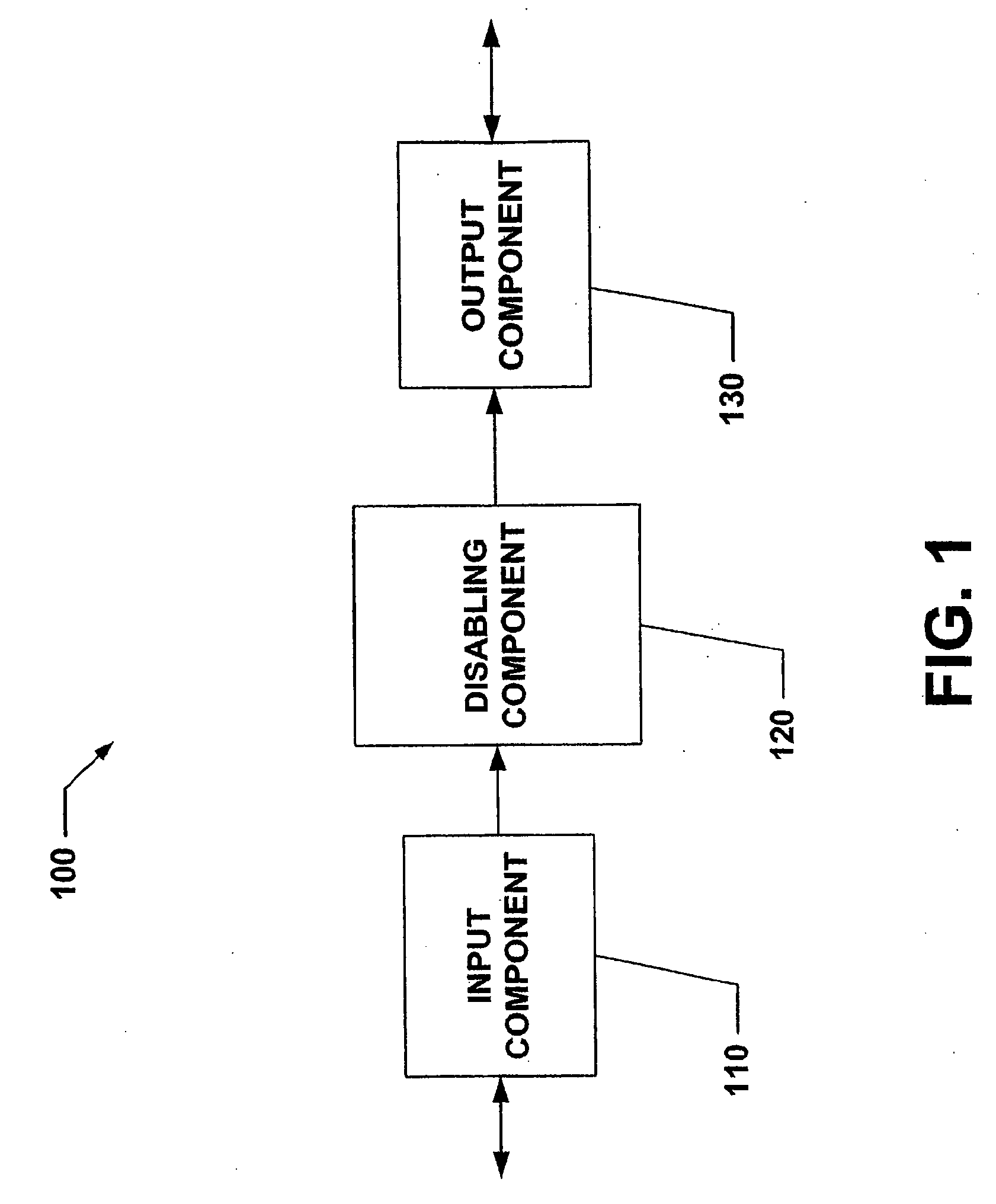

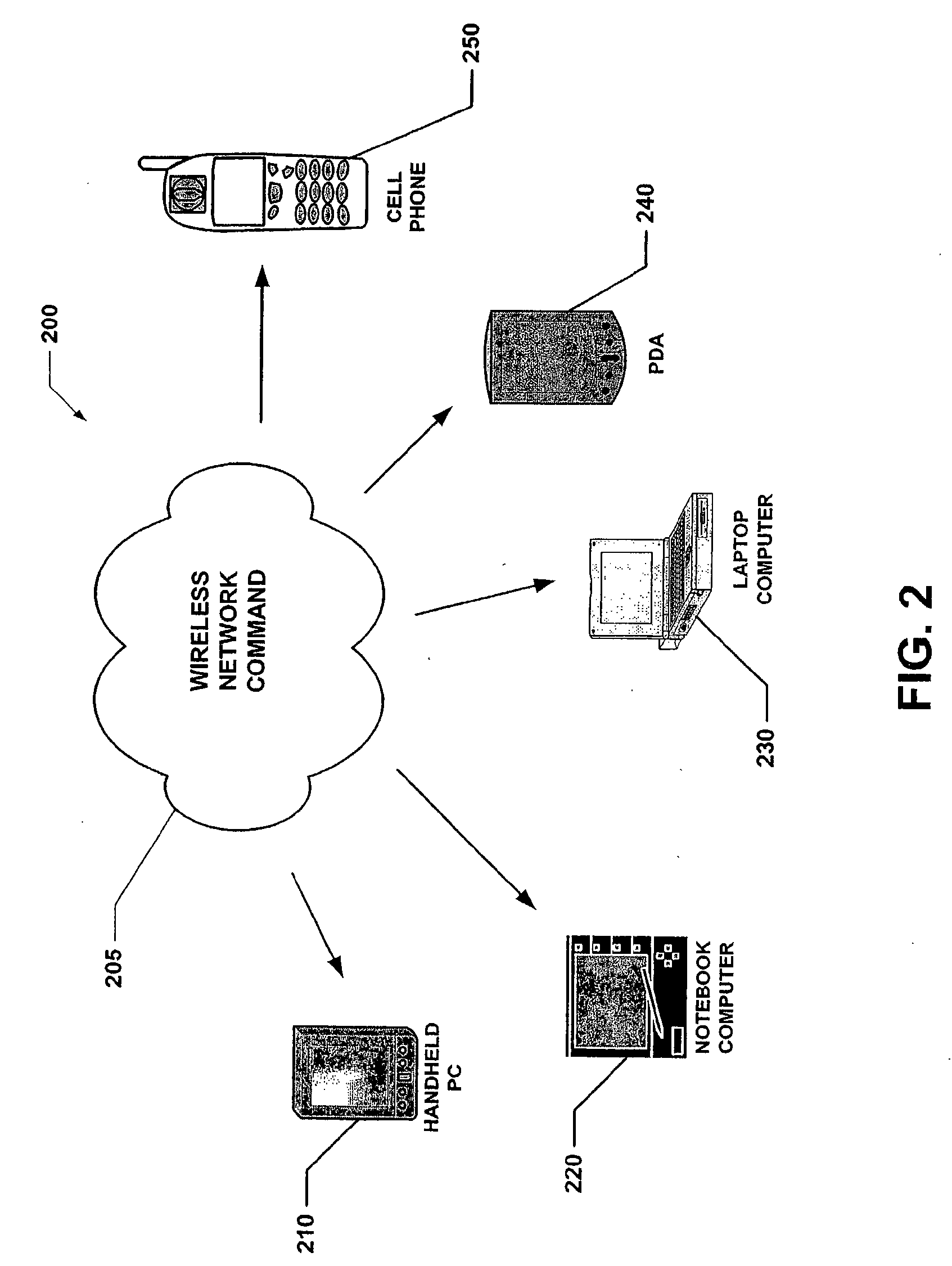

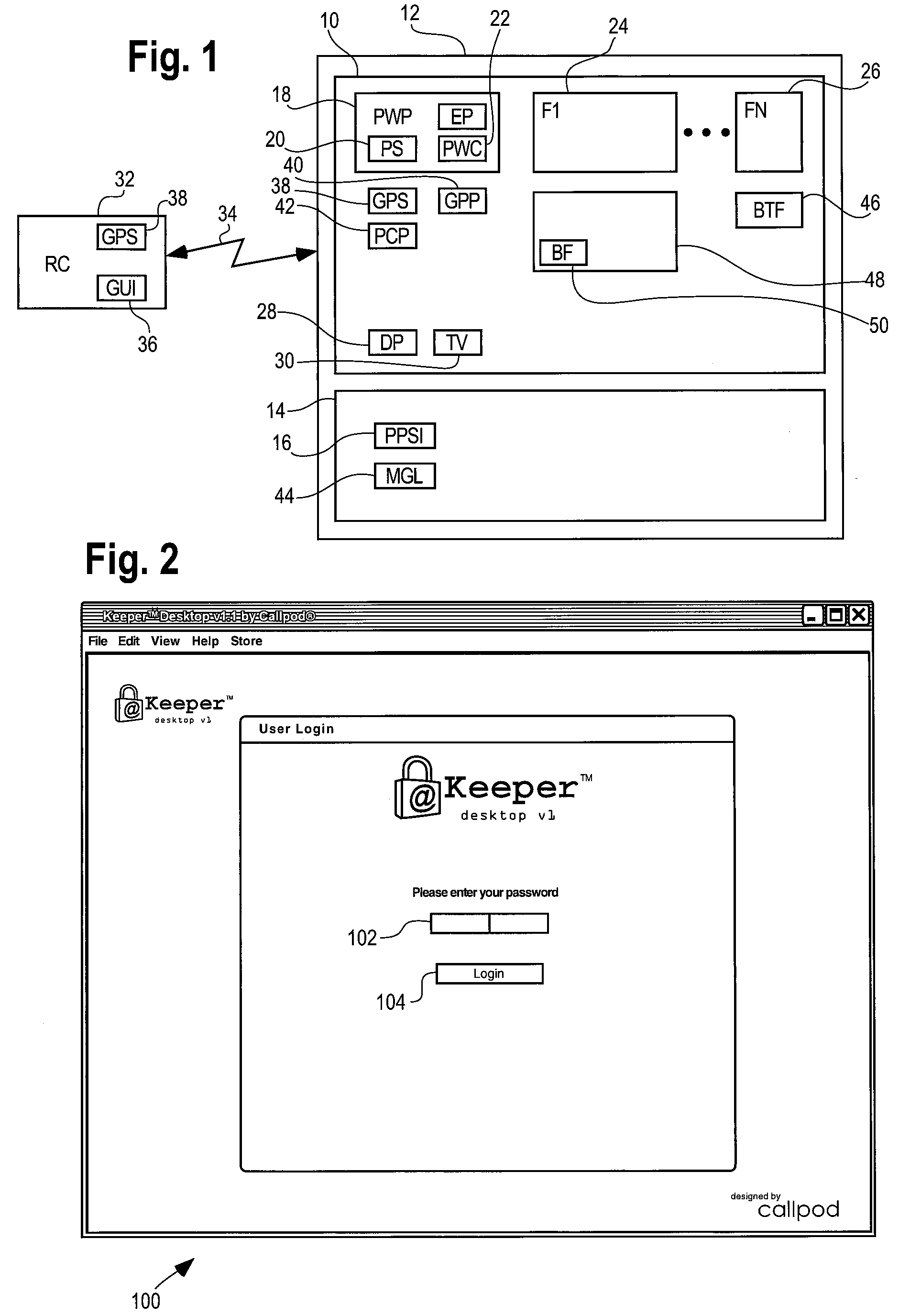

The present invention relates to systems and methods that employ various mechanisms to selectively disable mobile device functionality. In general, mobile devices can be utilized to store personal and / or highly sensitive information such as bank account numbers, social security numbers, credit card numbers and the like. If the mobile device is lost or stolen, data stored within the device can be accessed by an unauthorized user; and, thus, any personal and / or highly sensitive information can be obtained. In order to mitigate unauthorized access, the subject invention provides a disabling component that communicates with the lost or stolen device to render data stored thereon inaccessible. Further, the data can be stored in local or remote locations to backup stored information, thereby creating a more robust and reliable method of storing information important to the device owner. These features provide enhancements over conventional mobile device security techniques.

Owner:NOKIA CORP

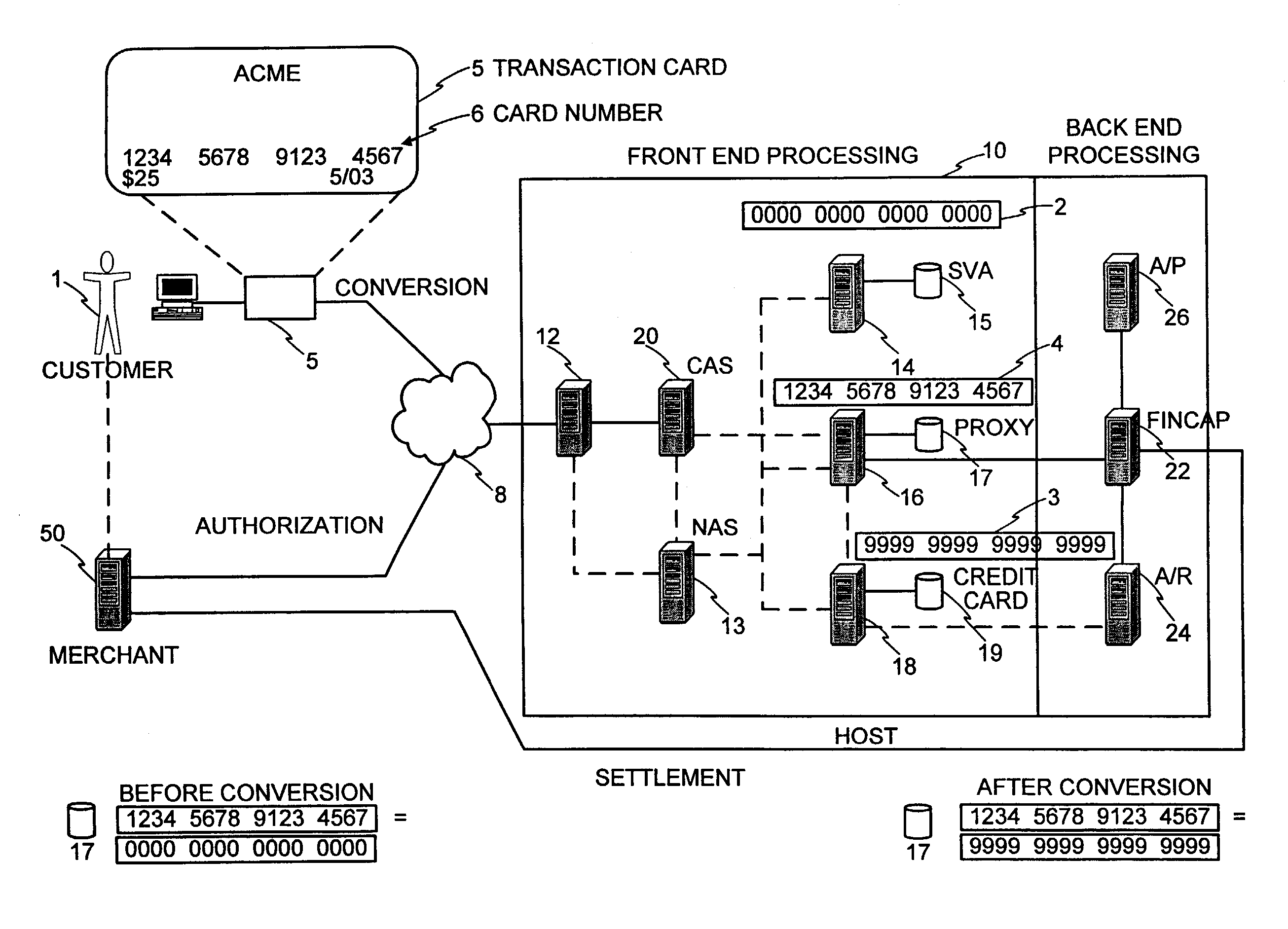

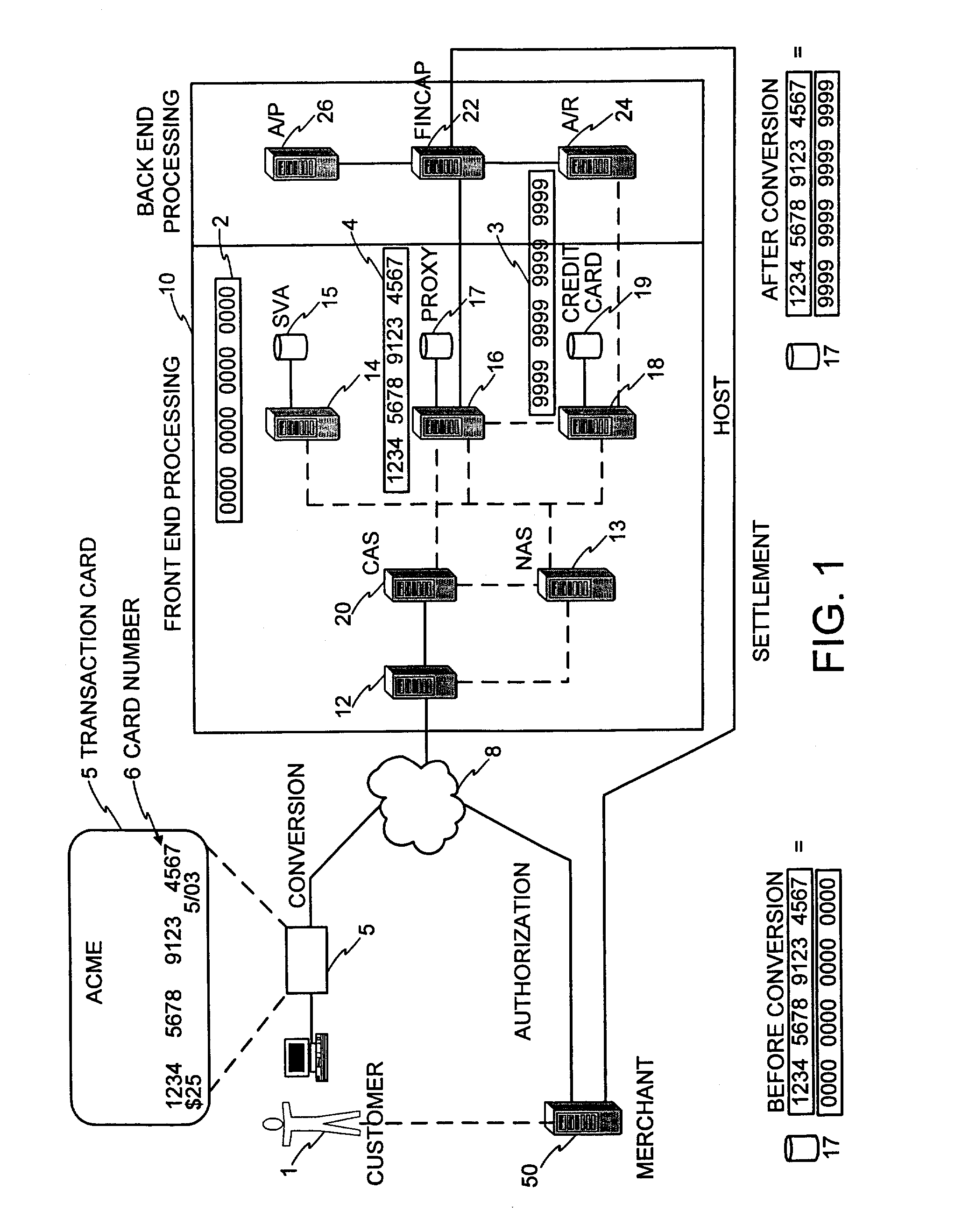

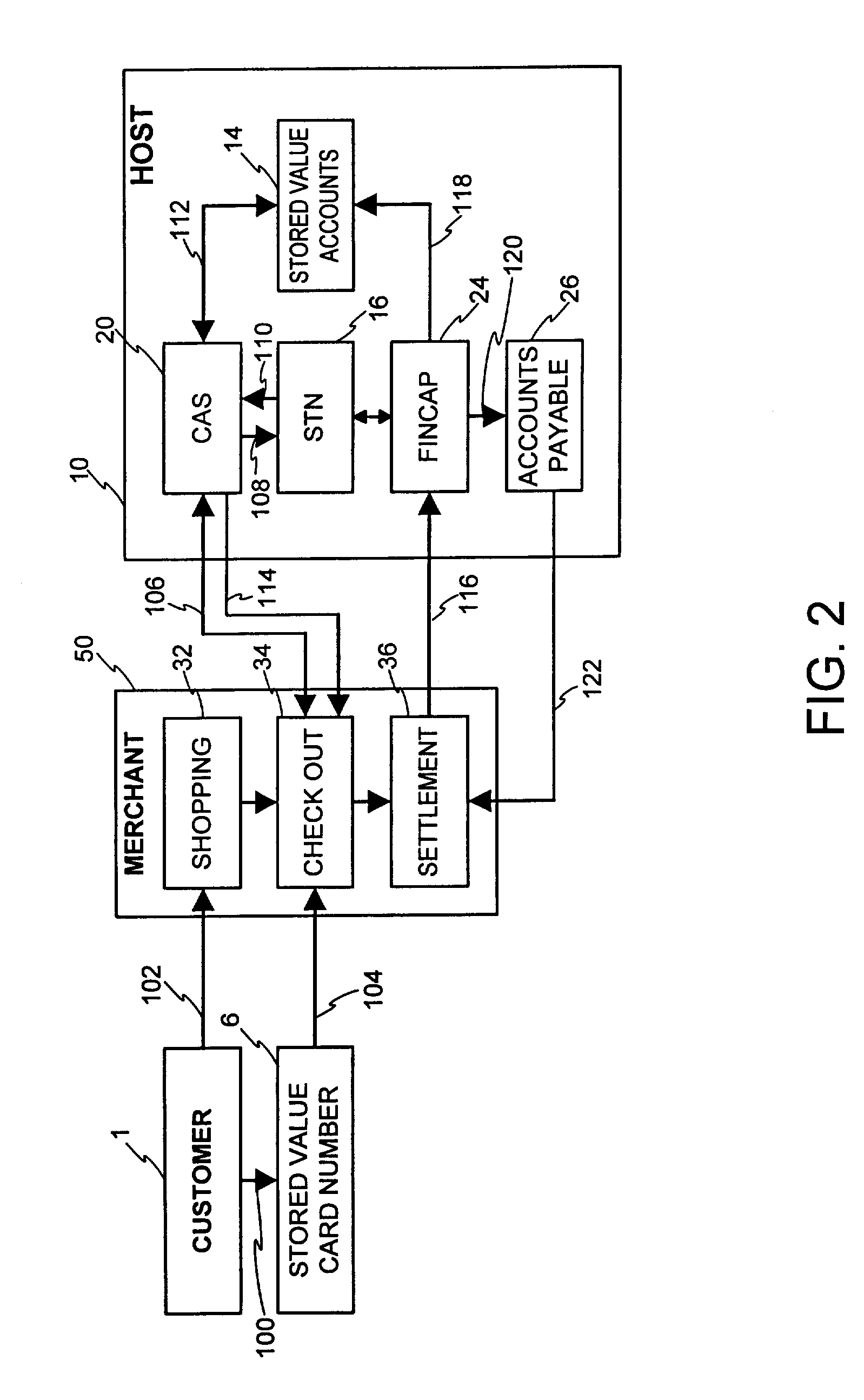

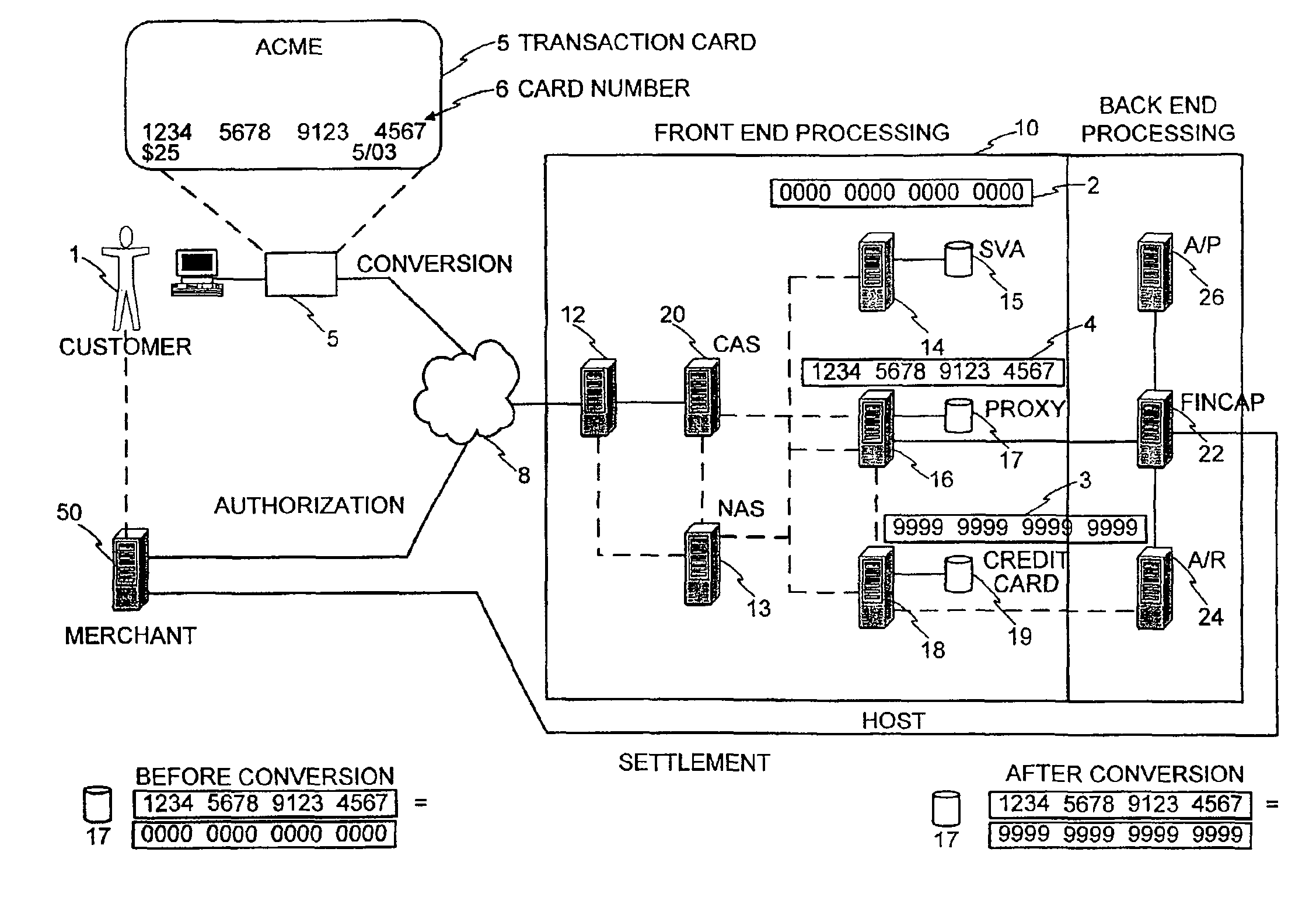

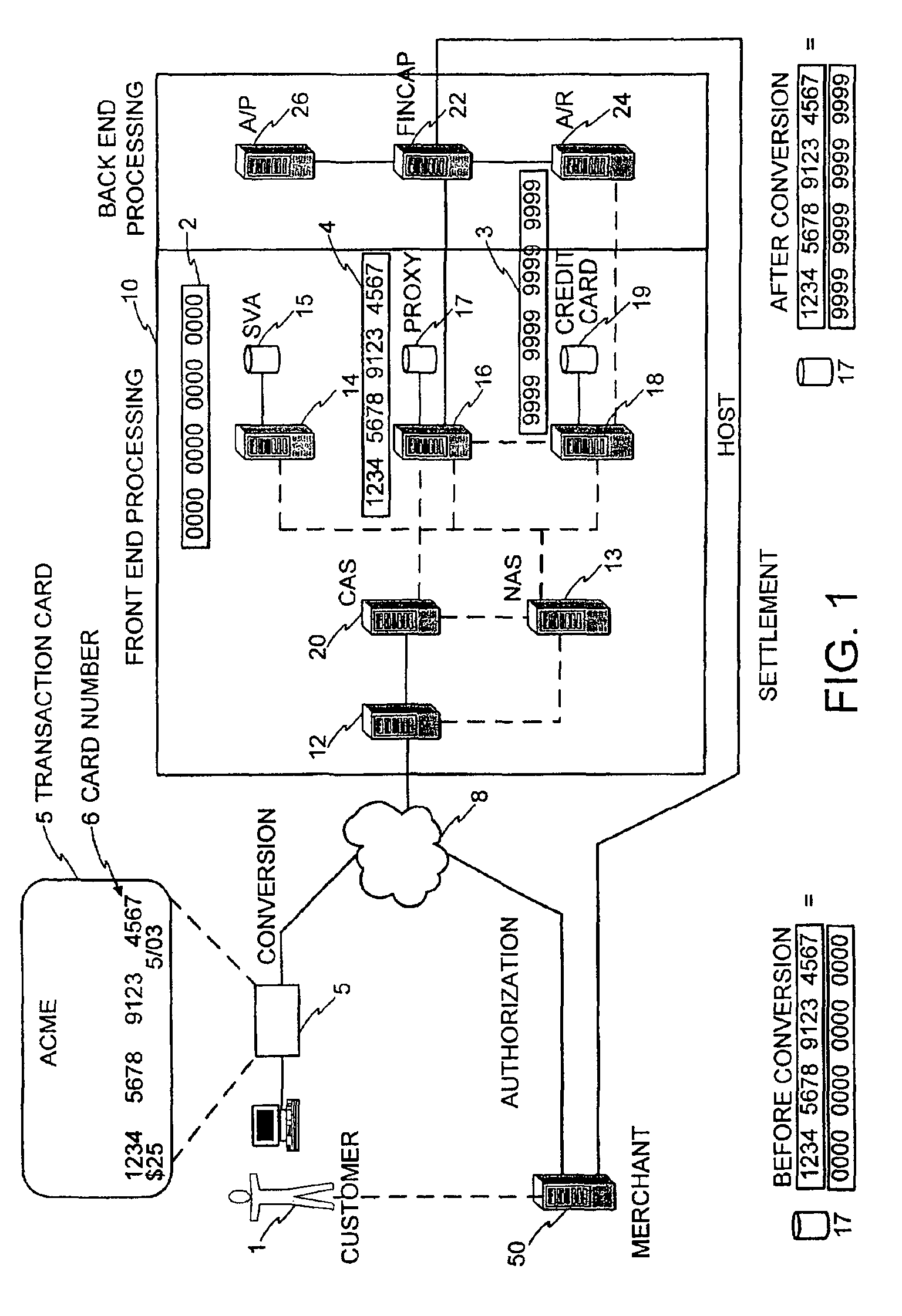

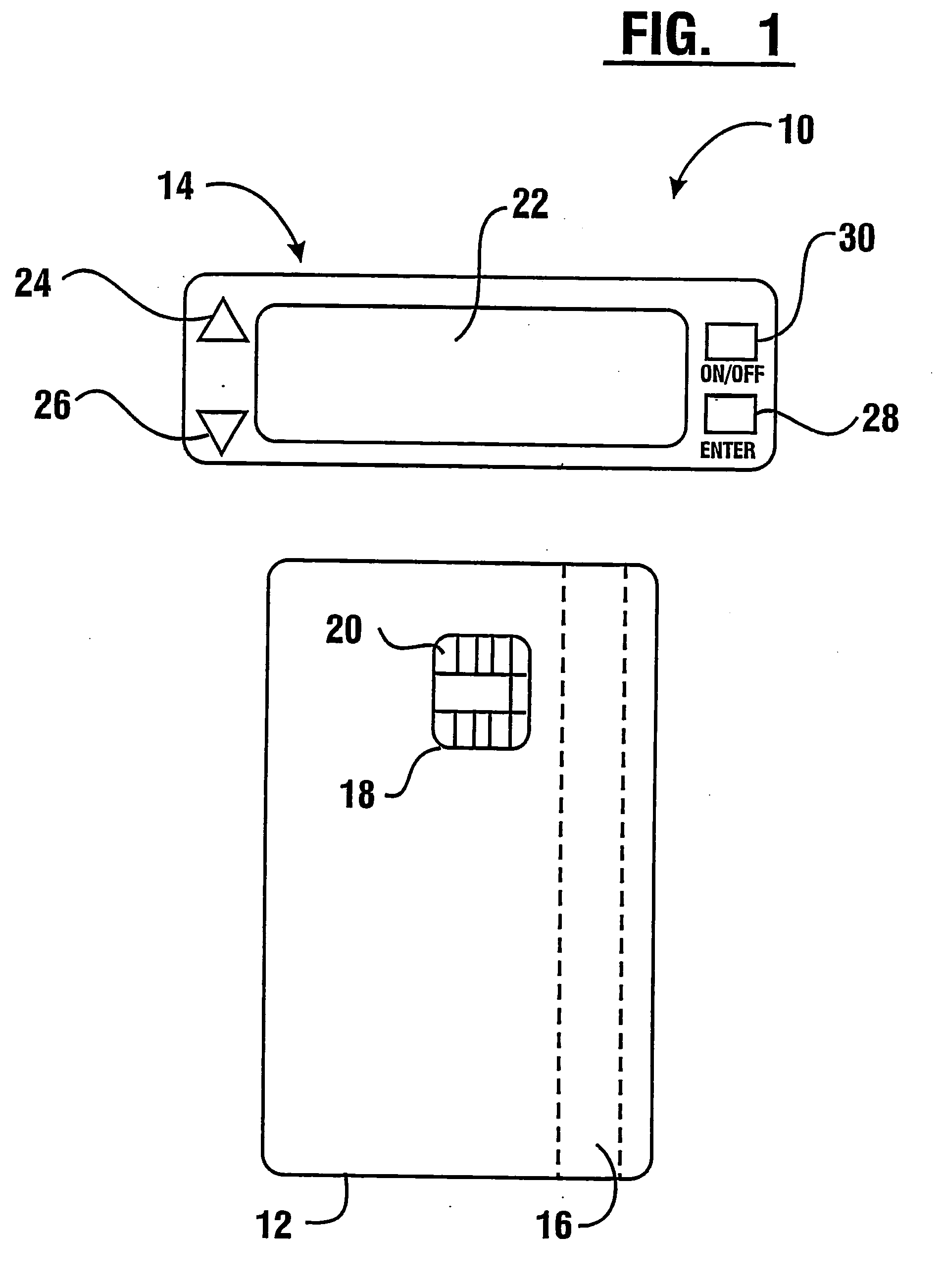

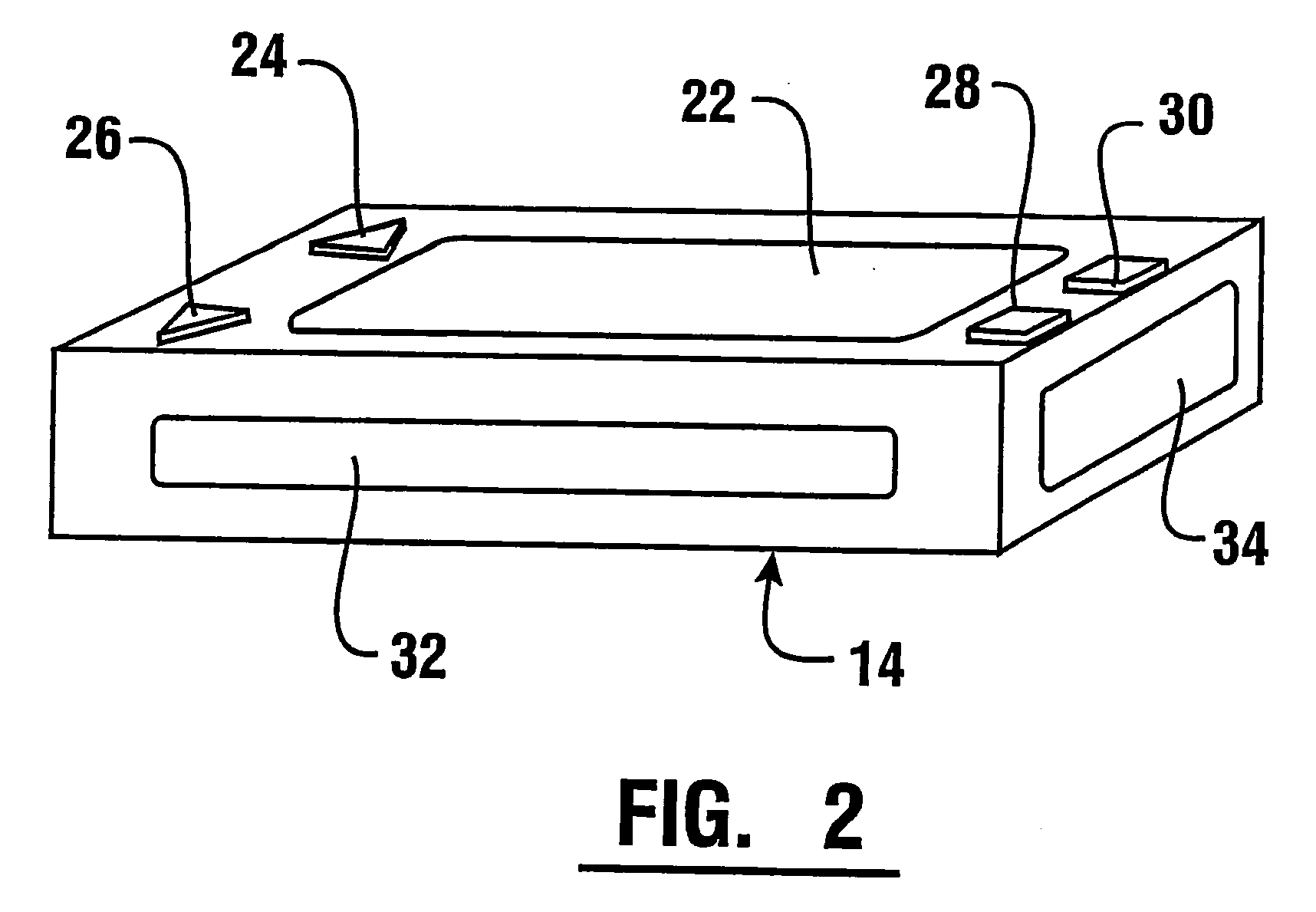

System and method for re-associating an account number to another transaction account

InactiveUS6991157B2Complete banking machinesCredit registering devices actuationCredit cardComputer science

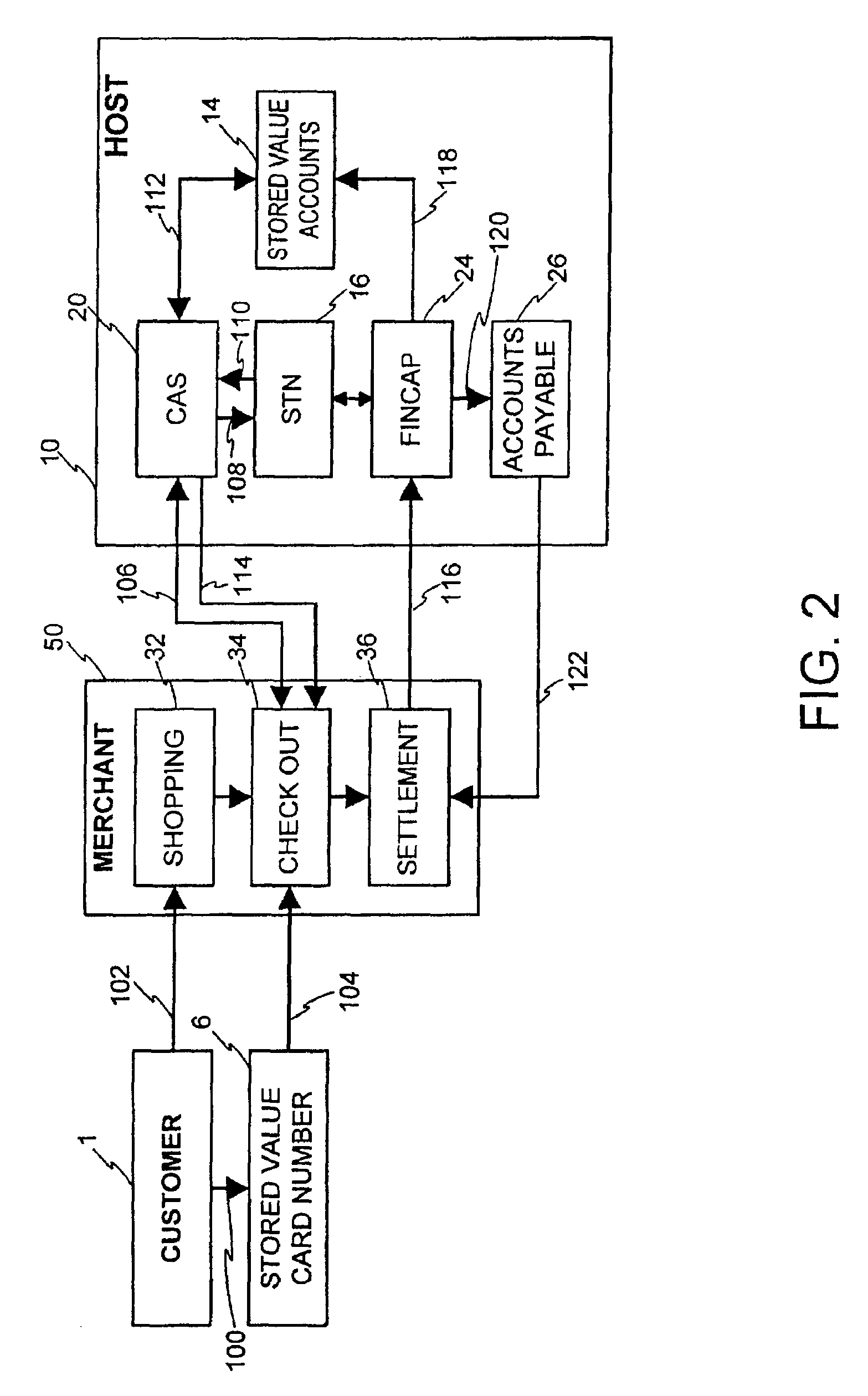

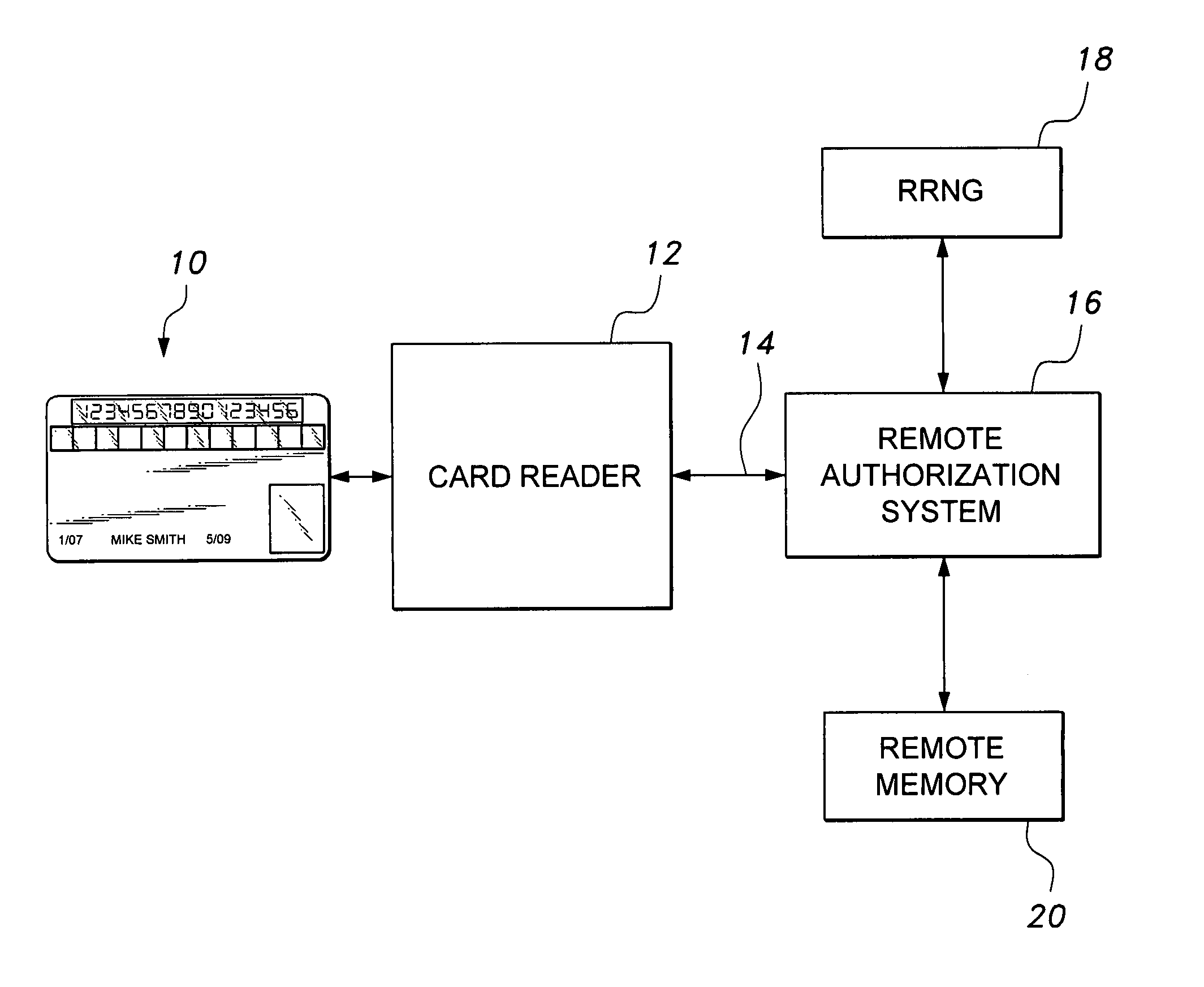

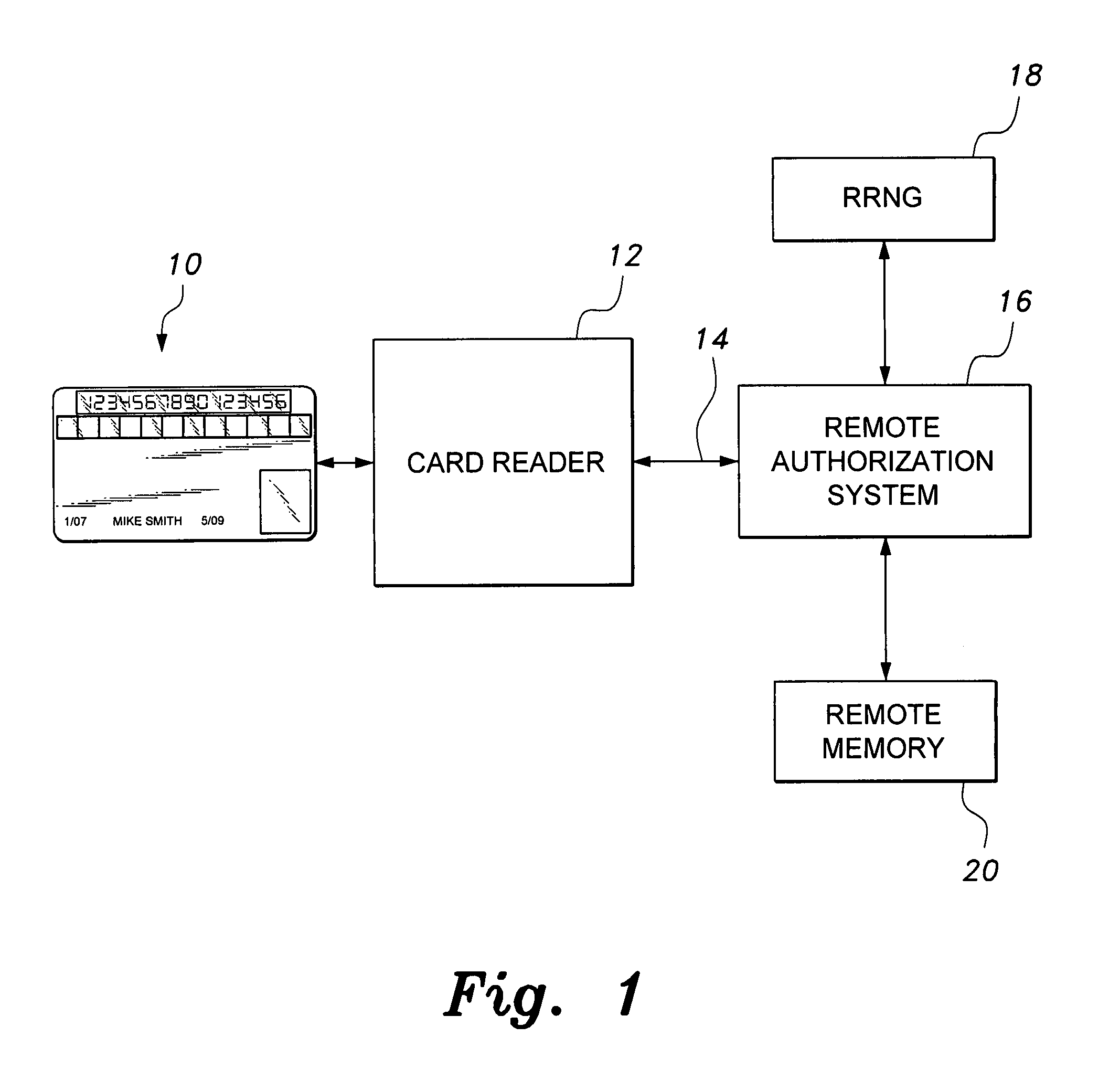

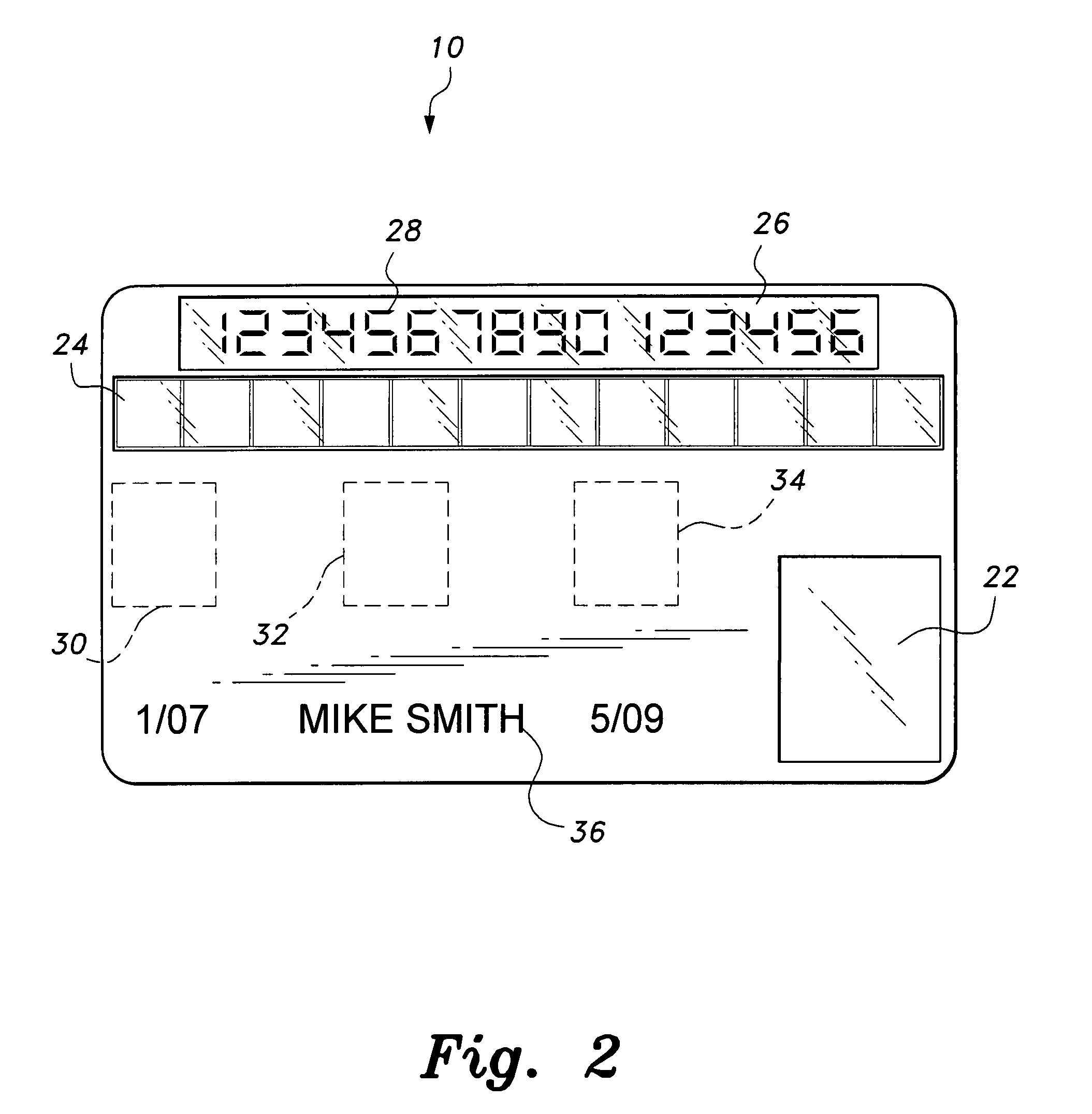

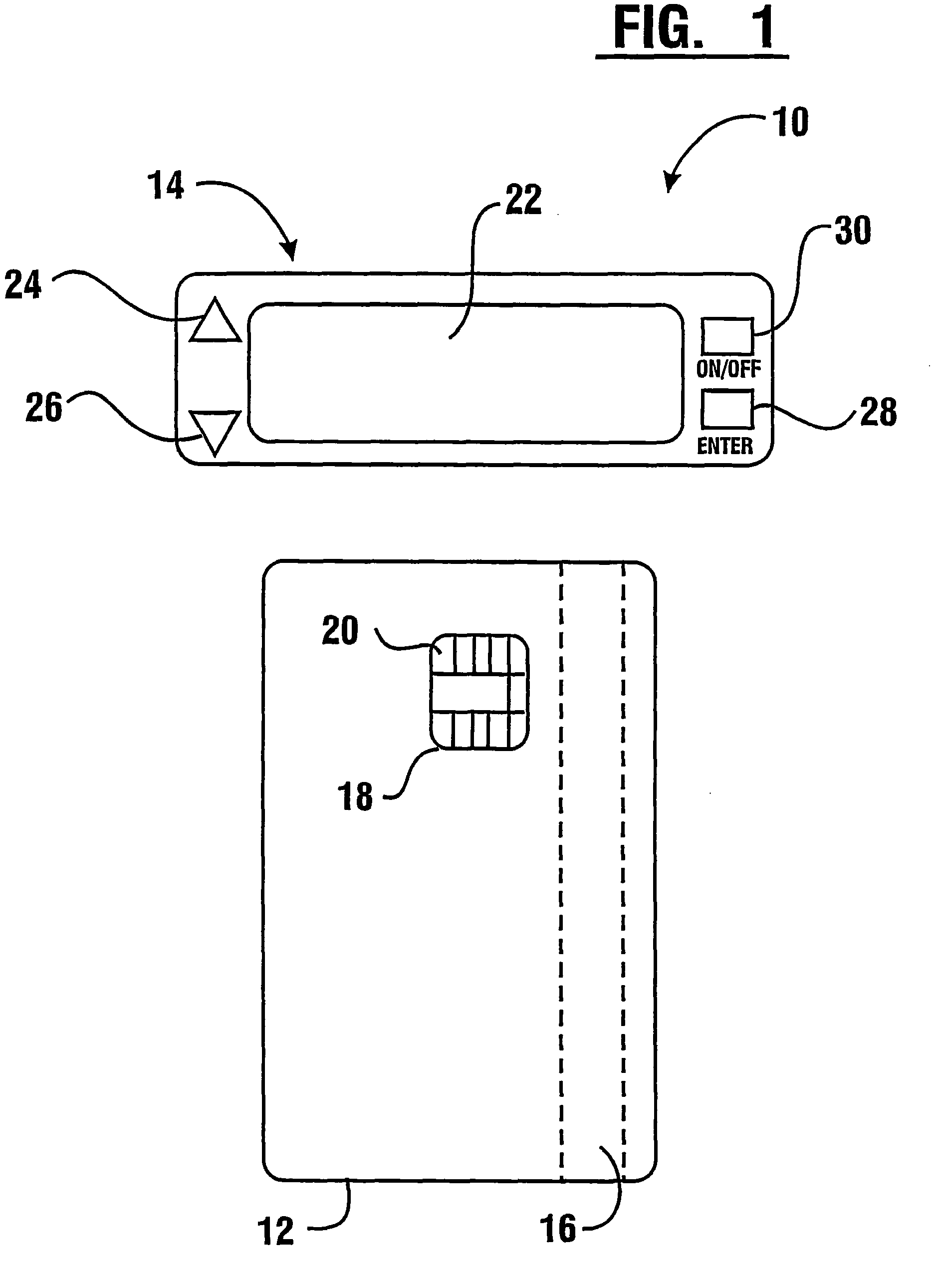

A method and system for converting a first transaction account device to a second transaction account device wherein a card number associated with, or defined as, a first transaction account (e.g., stored value account) is re-associated with, or re-defined as, a second transaction account (e.g., credit card account).

Owner:CHARTOLEAUX +1

System and method for re-associating an account number to another transaction account

InactiveUSRE43157E1Complete banking machinesCredit registering devices actuationCredit cardComputer science

A method and system for converting a first transaction account device to a second transaction account device wherein a card number associated with, or defined as, a first transaction account (e.g., stored value account) is re-associated with, or re-defined as, a second transaction account (e.g., credit card account).

Owner:LIBERTY PEAK VENTURES LLC

Smart card with random temporary account number generation

Owner:HEWTON ALFRED

Banking system controlled responsive to data bearing records

InactiveUS20090173781A1Reduce in quantityComplete banking machinesFinanceWireless transmissionCheque

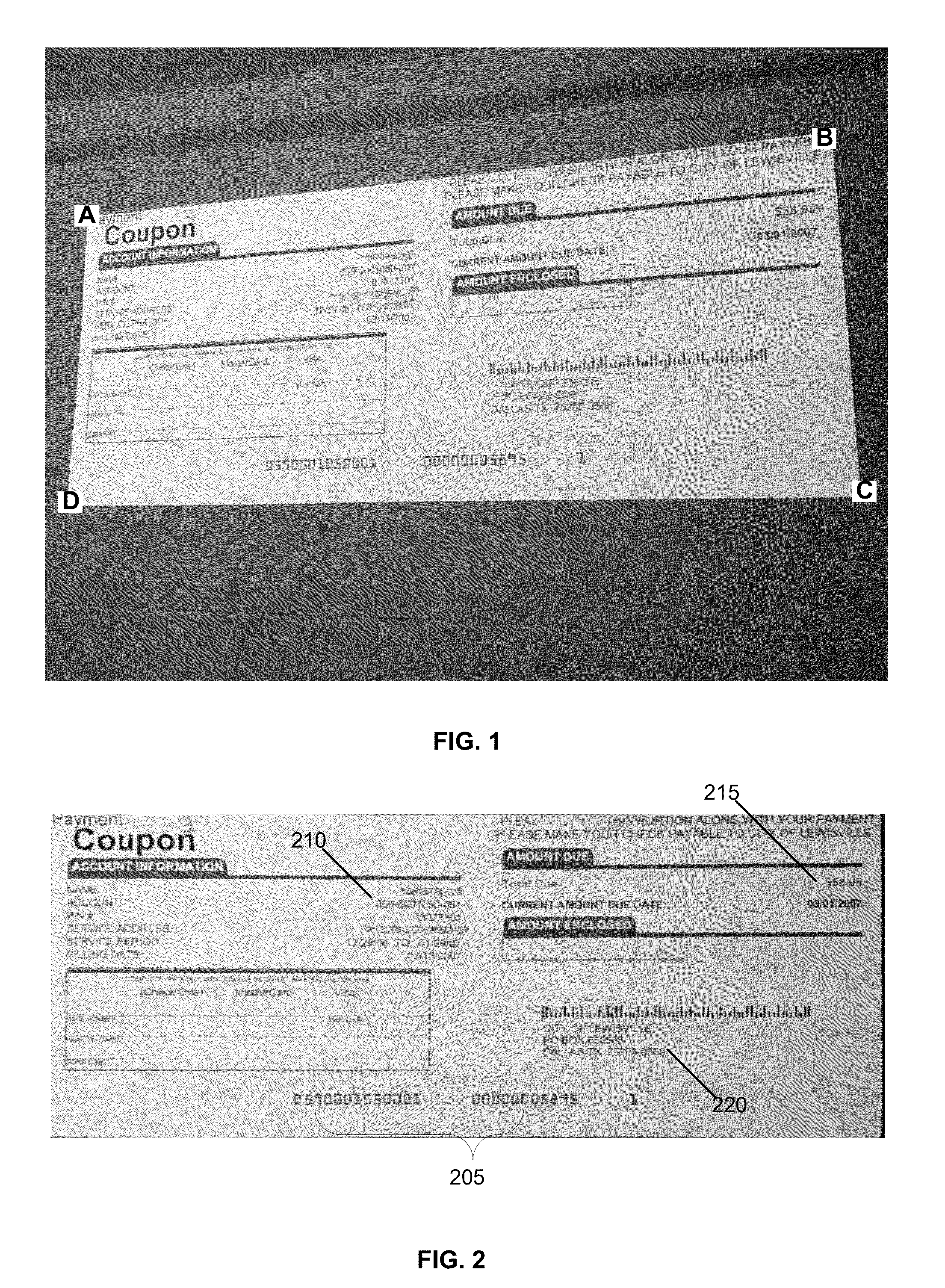

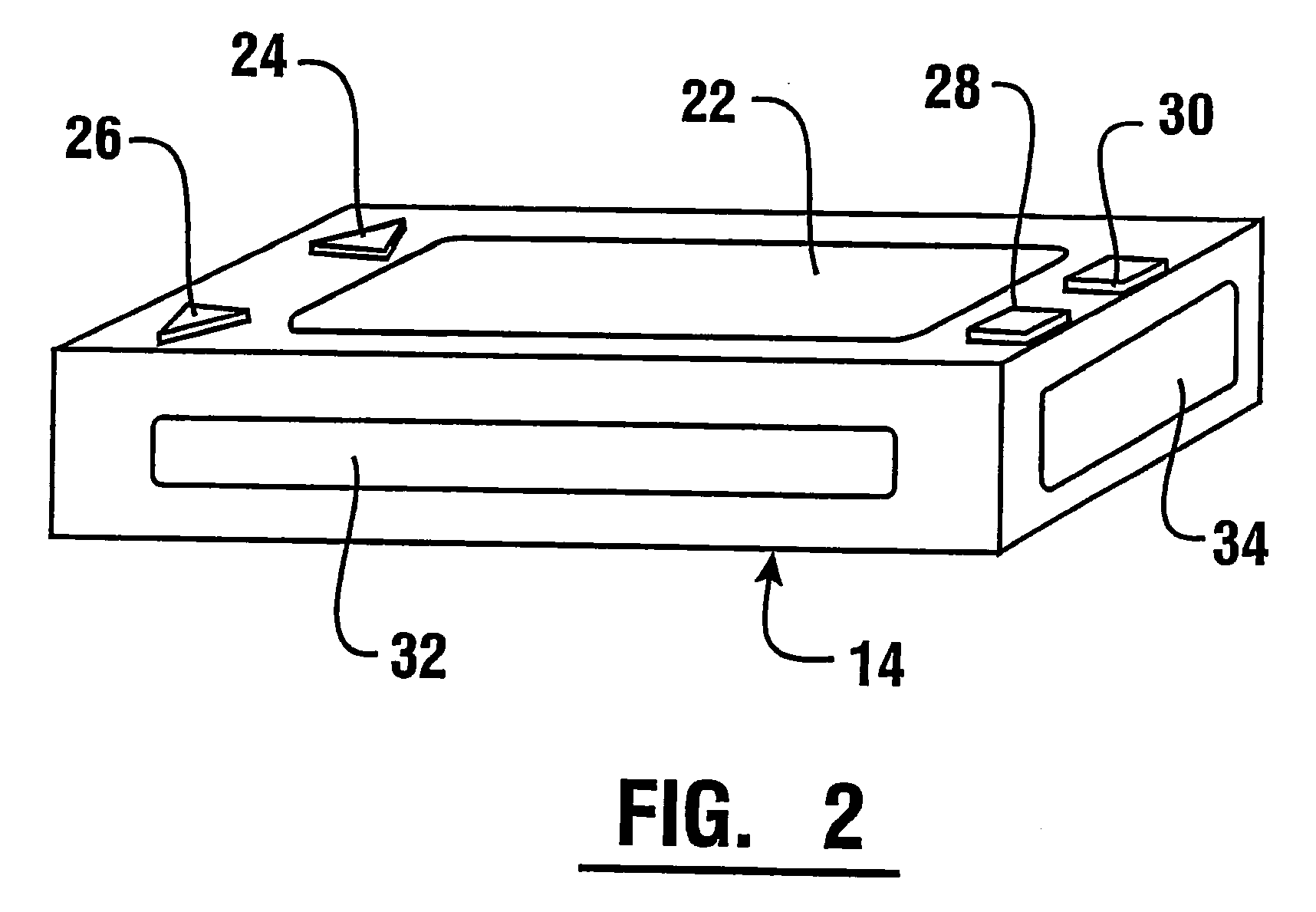

A banking system operates to allocate funds in accounts in response to data bearing records in the form of paper financial checks. A mobile phone has a camera and a programmable memory. The memory stores phone user data, including a bank account number and an electronic signature. The camera can be used to capture an image of a paper check which has the phone user as the payee. The phone can wirelessly transmit the account number, the electronic signature, and the check image to a bank deposit system. The system can store the check image and the electronic signature in correlated relation in a deposit transaction record. The system can cause the phone user's bank account to be credited a cash value corresponding to the check value. Confirmation of the check deposit can be transmitted to the user's phone.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

System and Method for Limiting Mobile Device Functionality.

ActiveUS20080233919A1Reduce harmPrevent unauthorized accessUnauthorised/fraudulent call preventionEavesdropping prevention circuitsCredit cardInternet privacy

The present invention relates to systems and methods that employ various mechanisms to selectively disable mobile device functionality. In general, mobile devices can be utilized to store personal and / or highly sensitive information such as bank account numbers, social security numbers, credit card numbers and the like. If the mobile device is lost or stolen, data stored within the device can be accessed by an unauthorized user; and, thus, any personal and / or highly sensitive information can be obtained. In order to mitigate unauthorized access, the subject invention provides a disabling component that communicates with the lost or stolen device to render data stored thereon inaccessible. Further, the data can be stored in local or remote locations to backup stored information, thereby creating a more robust and reliable method of storing information important to the device owner. These features provide enhancements over conventional mobile device security techniques.

Owner:NOKIA TECH OY

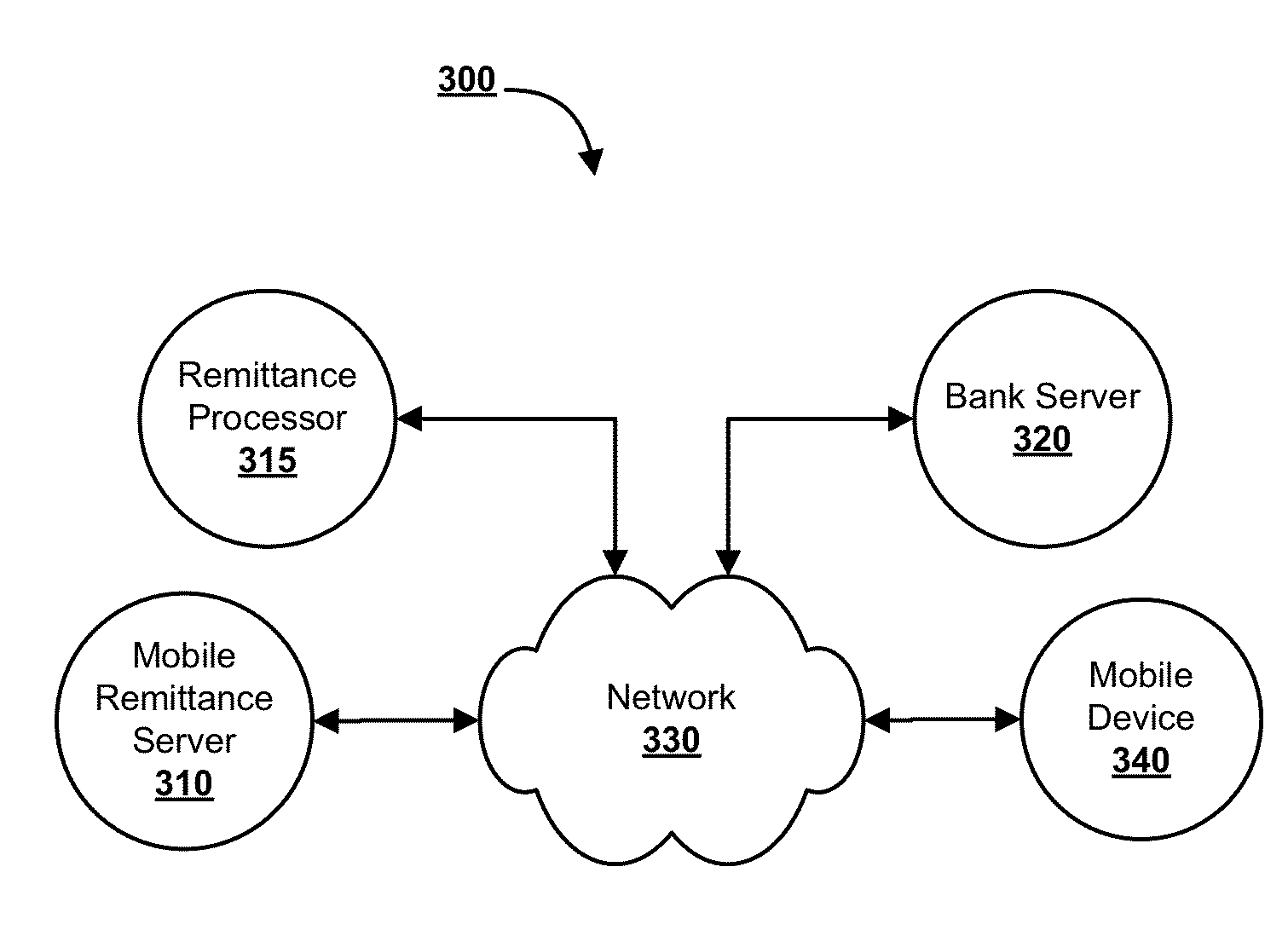

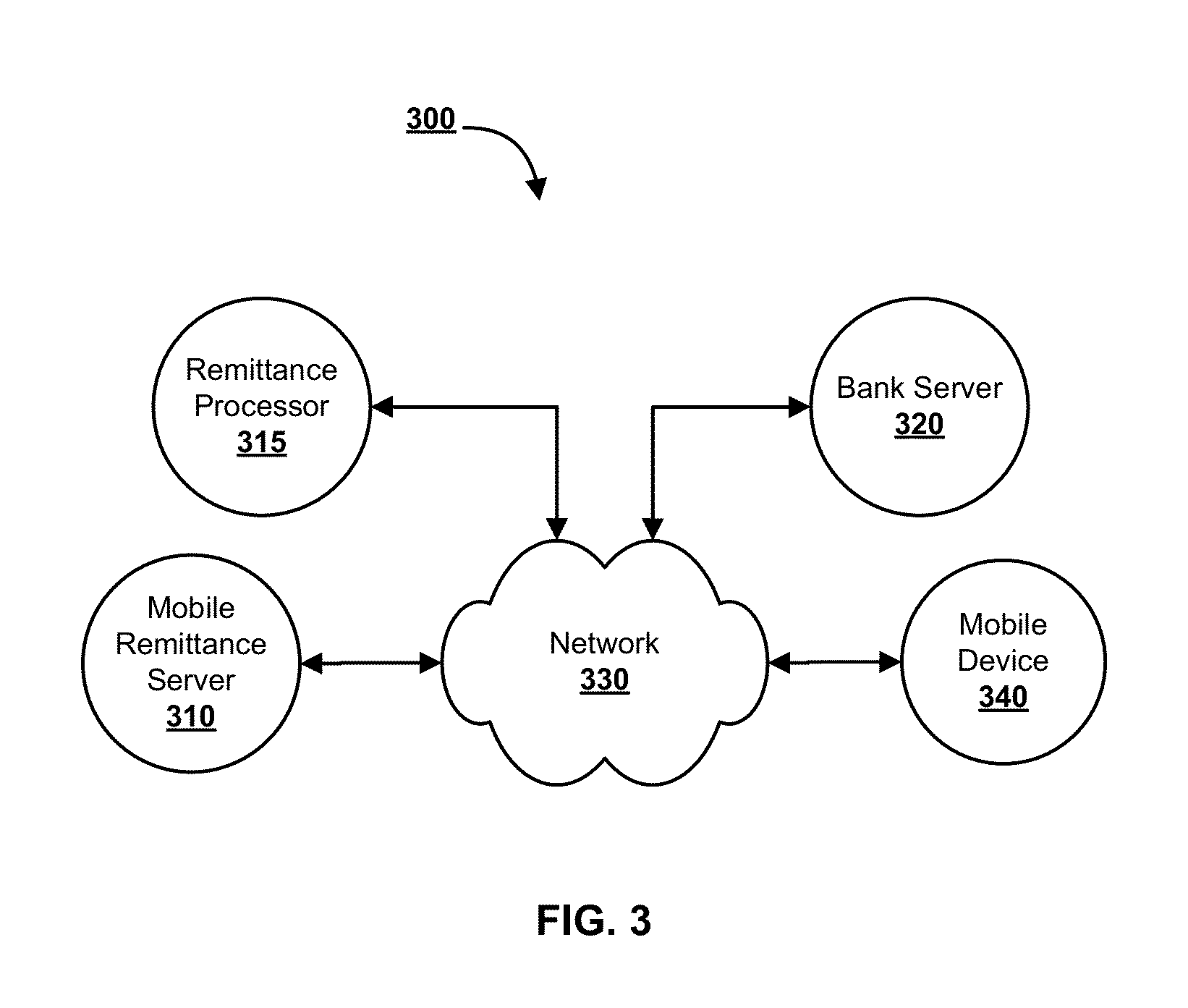

Systems and methods for mobile automated clearing house enrollment

Systems and methods for mobile enrollment in automated clearing house (ACH) transactions using mobile-captured images of financial documents are provided. Applications running on a mobile device provide for the capture and processing of images of documents needed for enrollment in an ACH transaction, such as a blank check, remittance statement and driver's license. Data from the mobile-captured images that is needed for enrolling in ACH transactions is extracted from the processed images, such as a user's name, address, bank account number and bank routing number. The user can edit the extracted data, select the type of document that is being captured, authorize the creation of an ACH transaction and select an originator of the ACH transaction. The extracted data and originator information is transmitted to a remote server along with the user's authorization so the ACH transaction can be setup between the originator's and receiver's bank accounts.

Owner:MITEK SYST

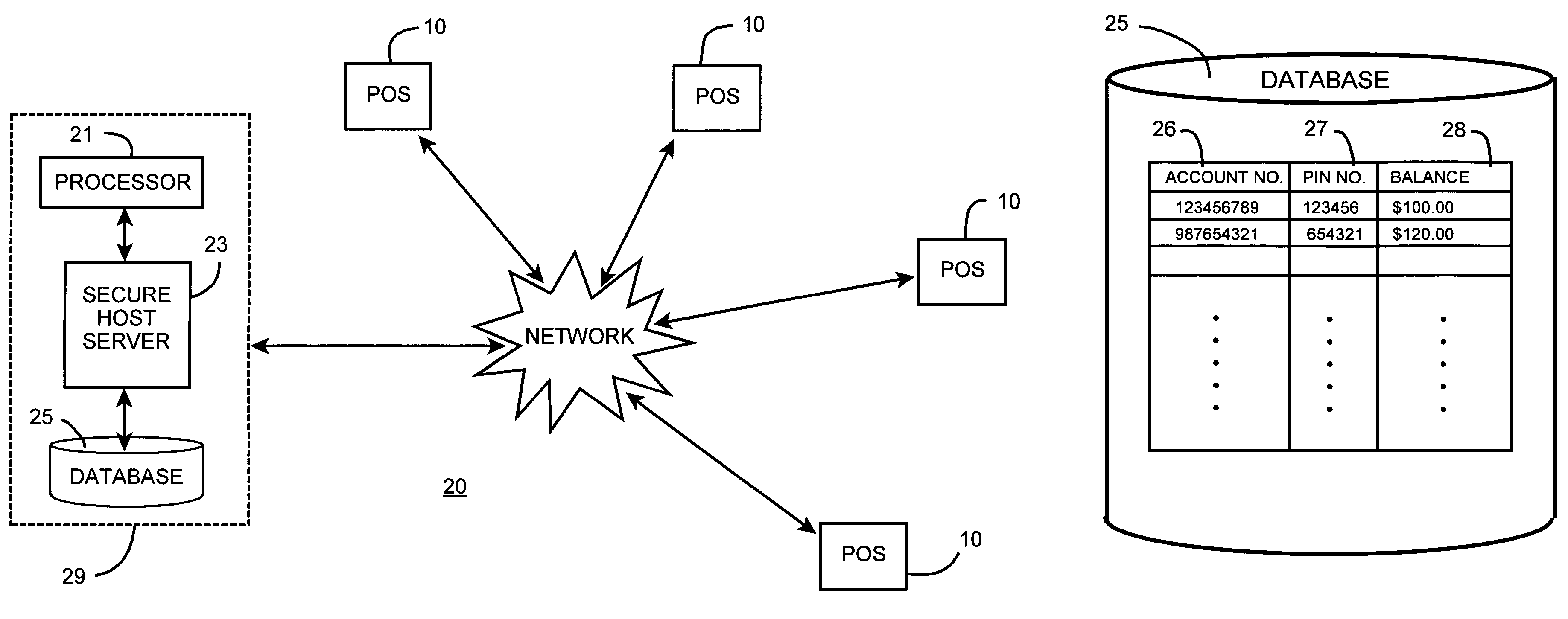

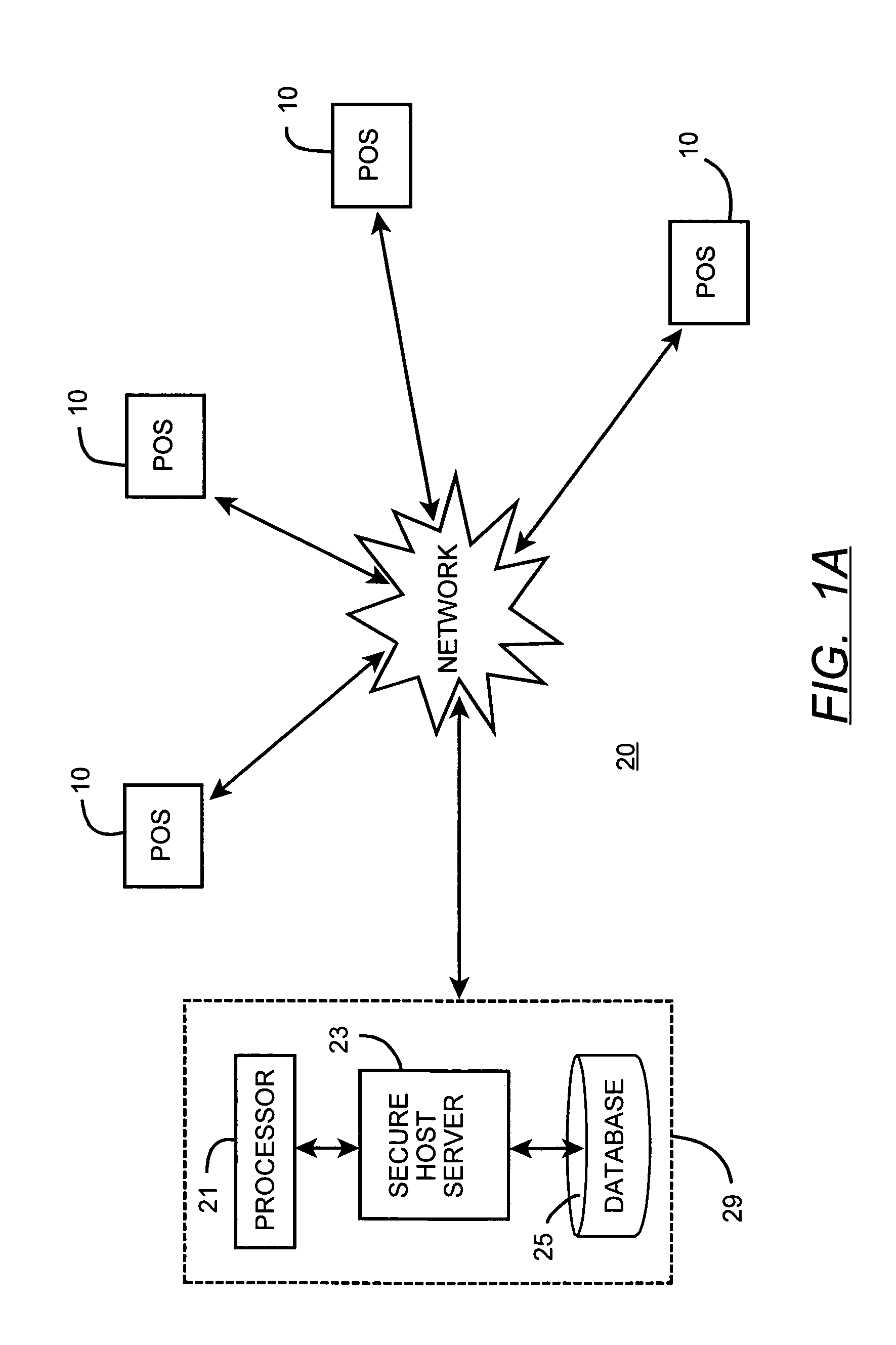

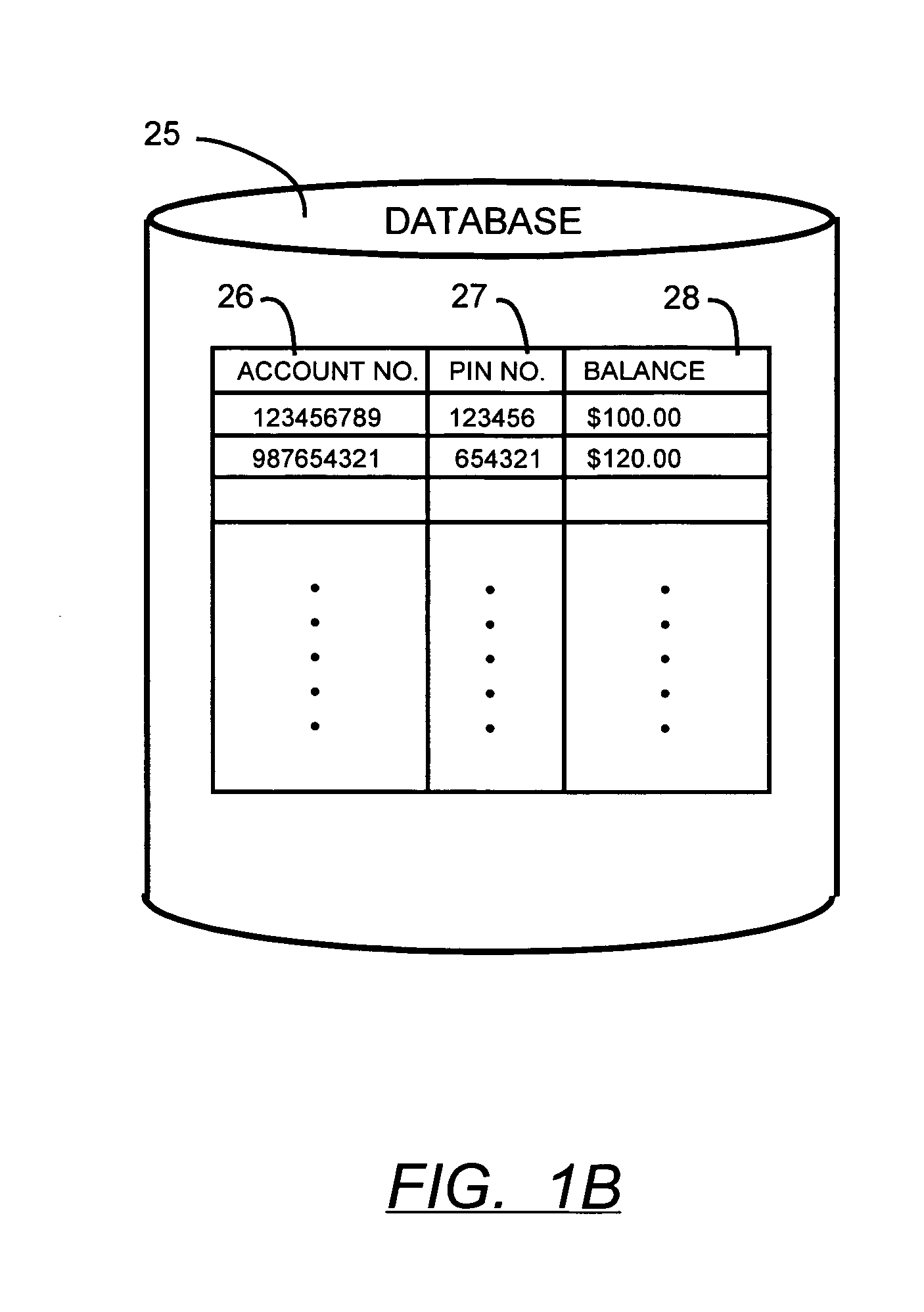

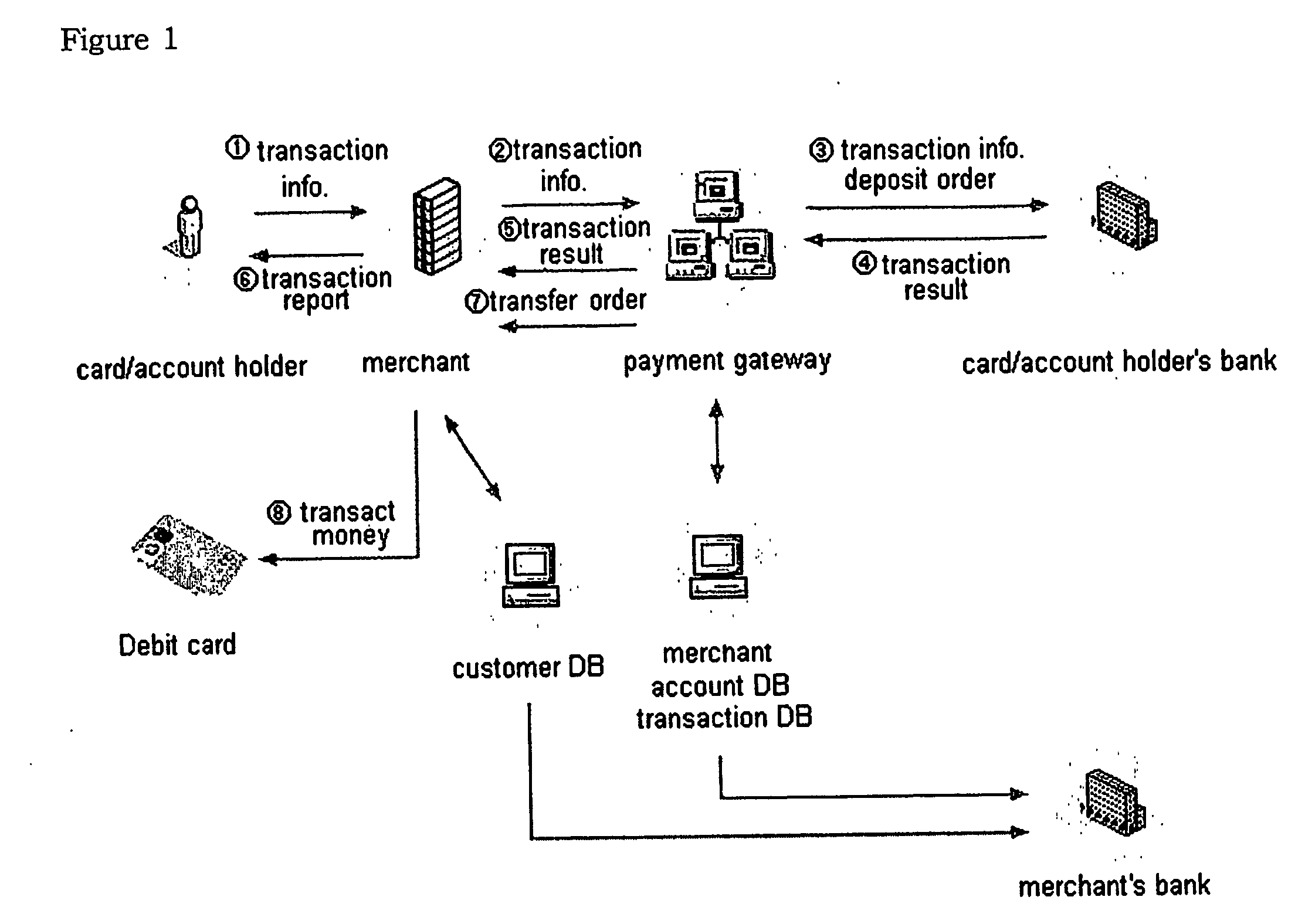

System and method for debit account transactions

InactiveUS7249054B2Minimize outlayPossibility of theftComplete banking machinesHand manipulated computer devicesPersonal identification numberComputer terminal

A system and method for establishing a debit account via a point of sale transaction terminal which is in communication with a secure host server. The transaction terminal includes an operating program for initiating a point of sale transaction to accept funds from a customer to be deposited into a debit account; transmitting the amount of the funds to the secure host server, receiving a debit account number and personal identifier number (PIN) unique to the transaction from the secure host server; and providing a printed receipt to the customer with the debit account number and PIN. The secure host server creates a debit account having a unique debit account number specific to the transaction, stores a electronic representation of currency equivalent to the input value into the debit account; and associates a personal identification number (PIN) with the debit account. The invention further includes a database for storing the debit account number and PIN number which also maintains account balance information associated with the debit account number. The funds can then be withdrawn from the debit account by a customer using the debit account number and PIN. Personal identification data from the customer is not required to establish the account, and the account holder identity can remain anonymous.

Owner:AIRTIME TECH

Bank account number validation

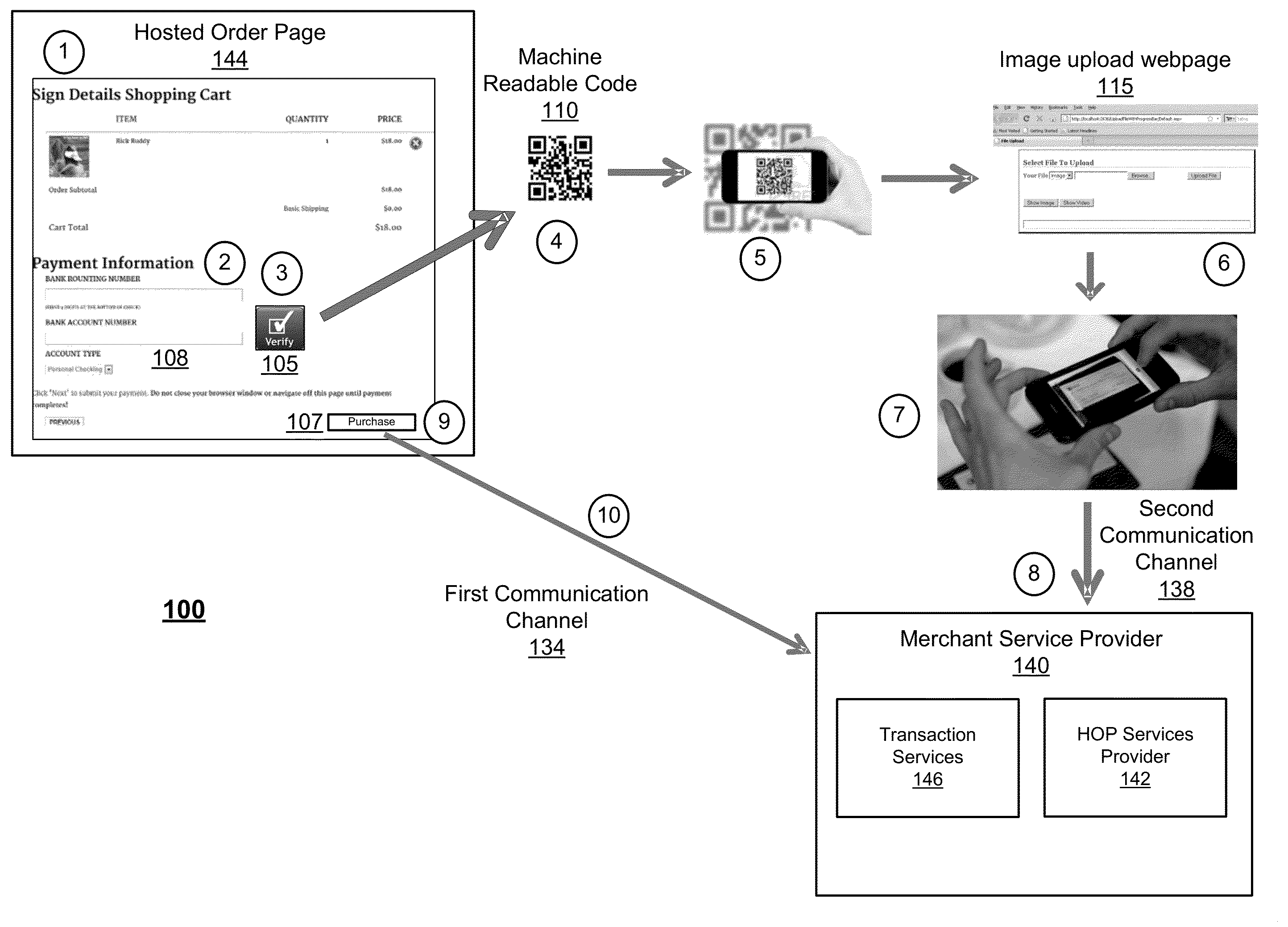

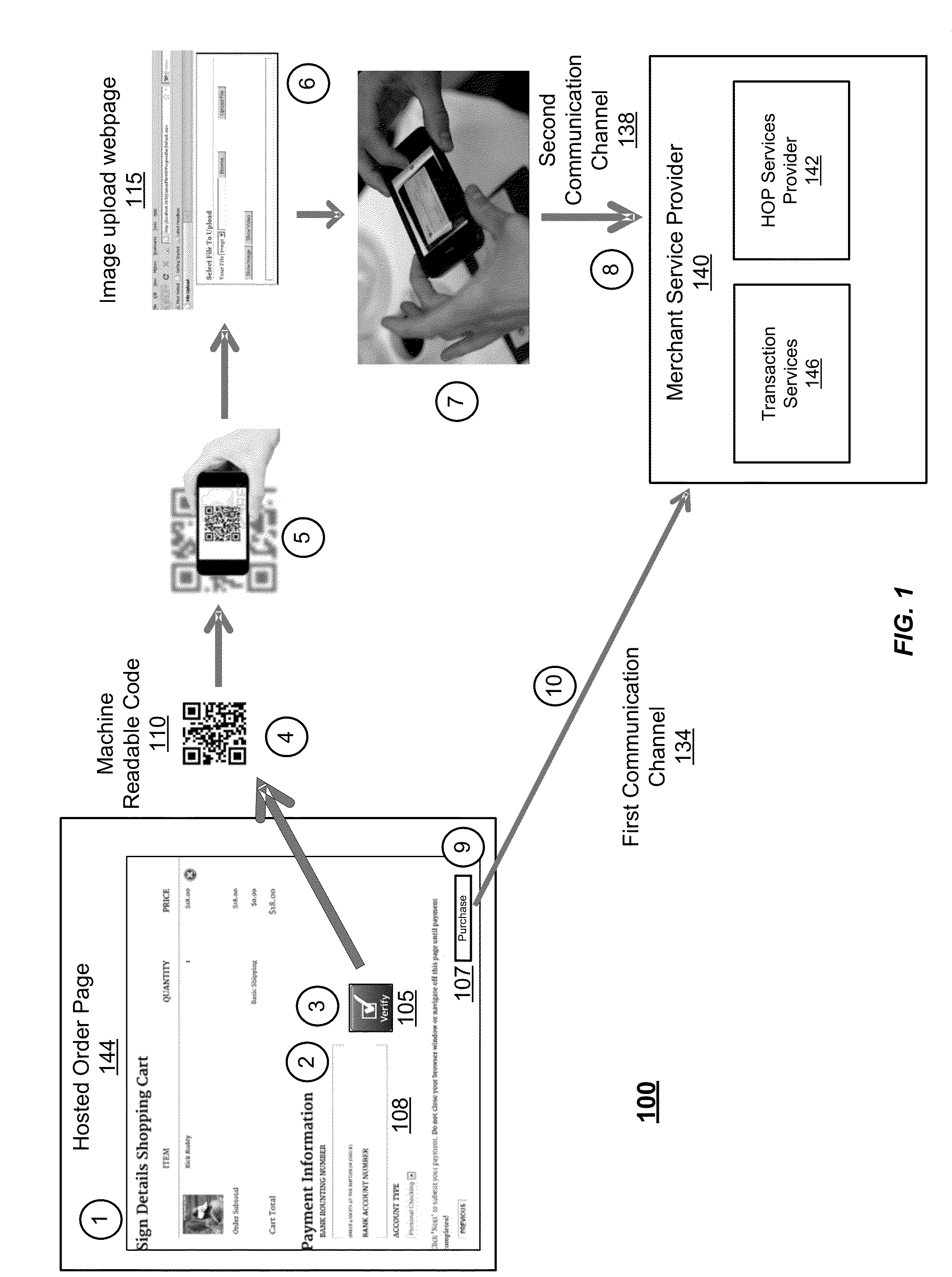

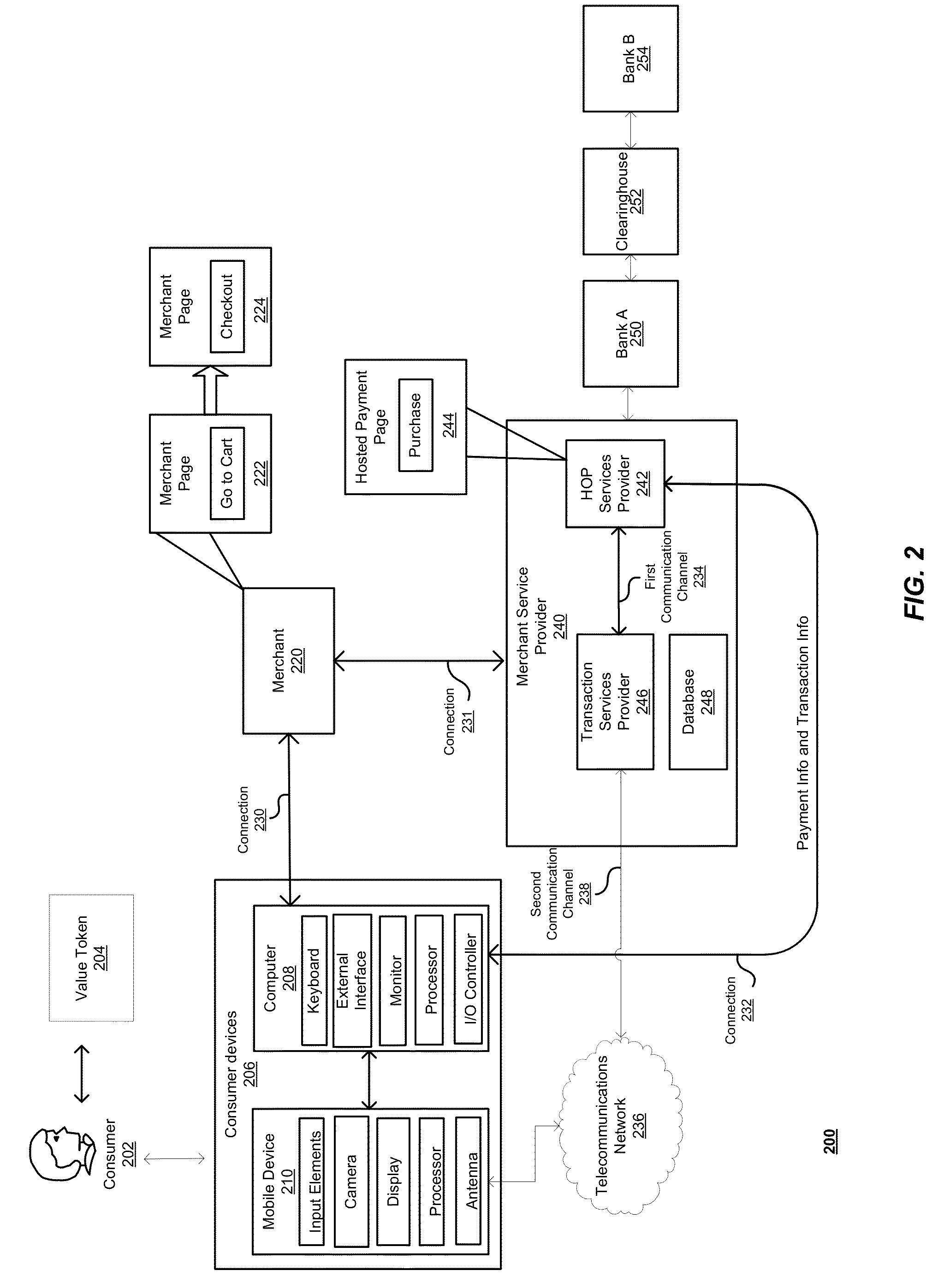

A method for validating payment information for an online transaction is provided. A payment server can receive two representations of the same payment information. The payment information can be validated if it is determined that the two representations match. If there is no match, or the payment information is otherwise invalid, the payment information can be repaired based on a trusted representation of the payment information, such as stored payment information or an image of an associated value token. Payment information can be received via one or more communication channels, and can be provided by one or more consumer devices. A merchant service provider can validate payment information and handle transaction processing on behalf of a merchant.

Owner:VISA INT SERVICE ASSOC

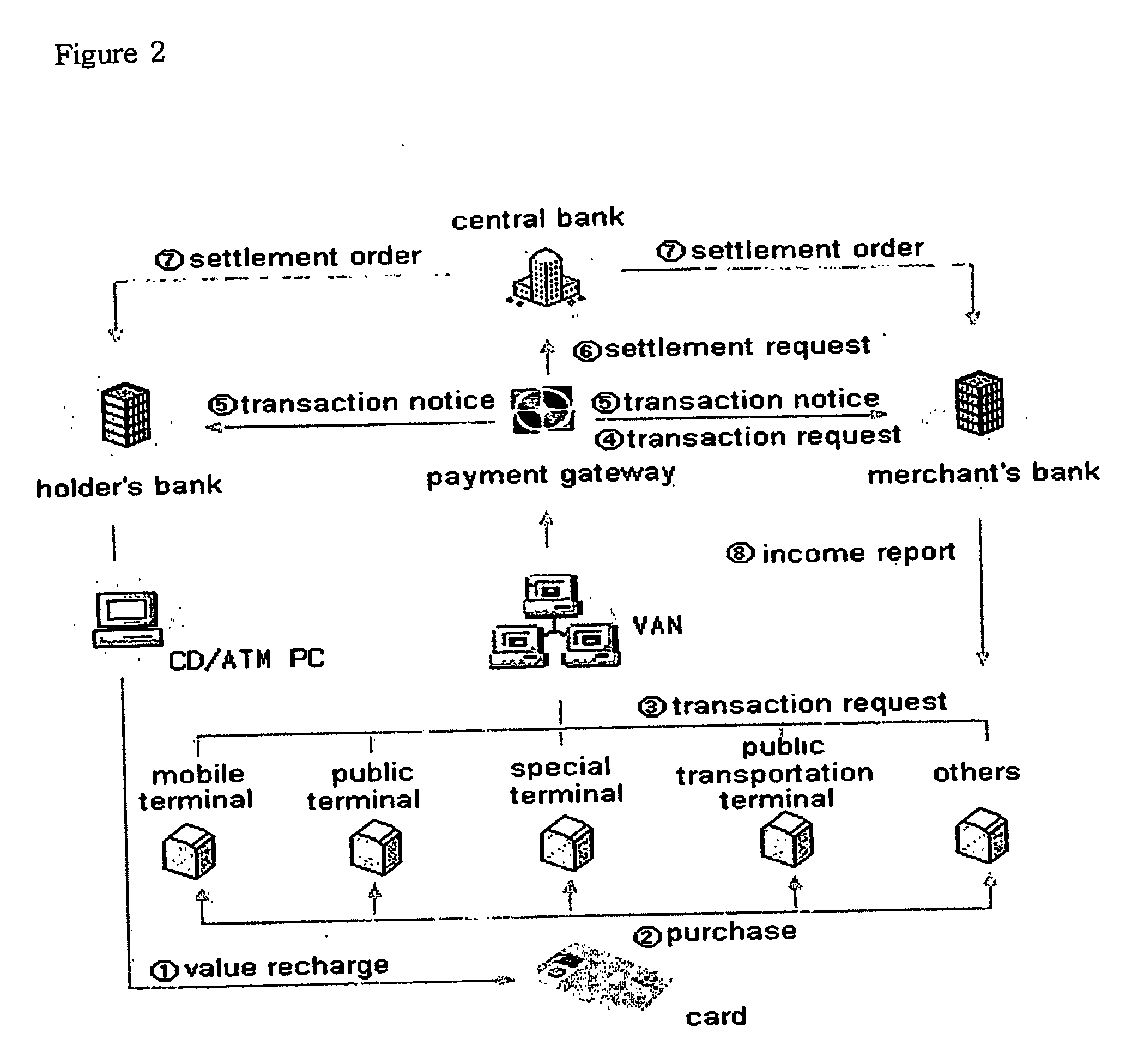

Bank transaction method linking accounts via common accounts

InactiveUS20070130062A1Solve the inconvenienceMaximize the benefitsComplete banking machinesFinanceFinancial transactionData format

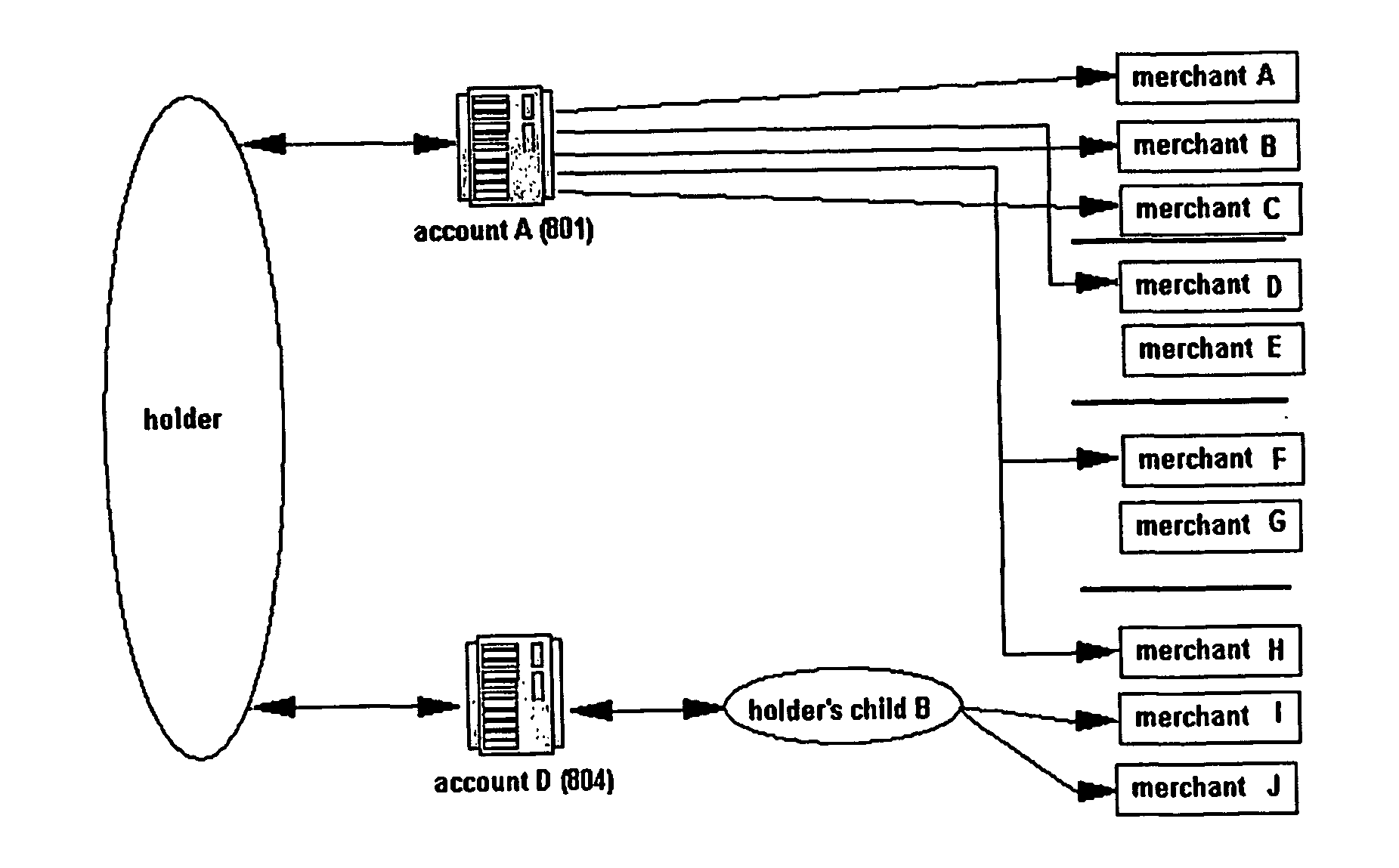

The present invention discloses a bank transaction method linking accounts via common accounts, wherein the existing accounts of the account holder and / or newly opened plural accounts link arbitrarily as defined by the account holder for convenient transactions between account holder's primary account and other's secondary accounts without using account numbers of the concerned accounts. To fulfill, the purpose, the present invention enables the account holder to make transactions on a primary account as well on linked secondary accounts in real time; and the said primary and secondary accounts are also offered for independent transaction as ordinary bank accounts. In addition, the classification and management of the said primary and secondary accounts are attainable through the individual account number with specified account code given by the bank to achieve transactions between the said primary and secondary accounts while implementing the conventional banking system. Furthermore, transaction to the external transaction network including payment gateway can be processed without changing the existing data format, both of account holders' and bank's convenience is maximized.

Owner:HUH INGHOO

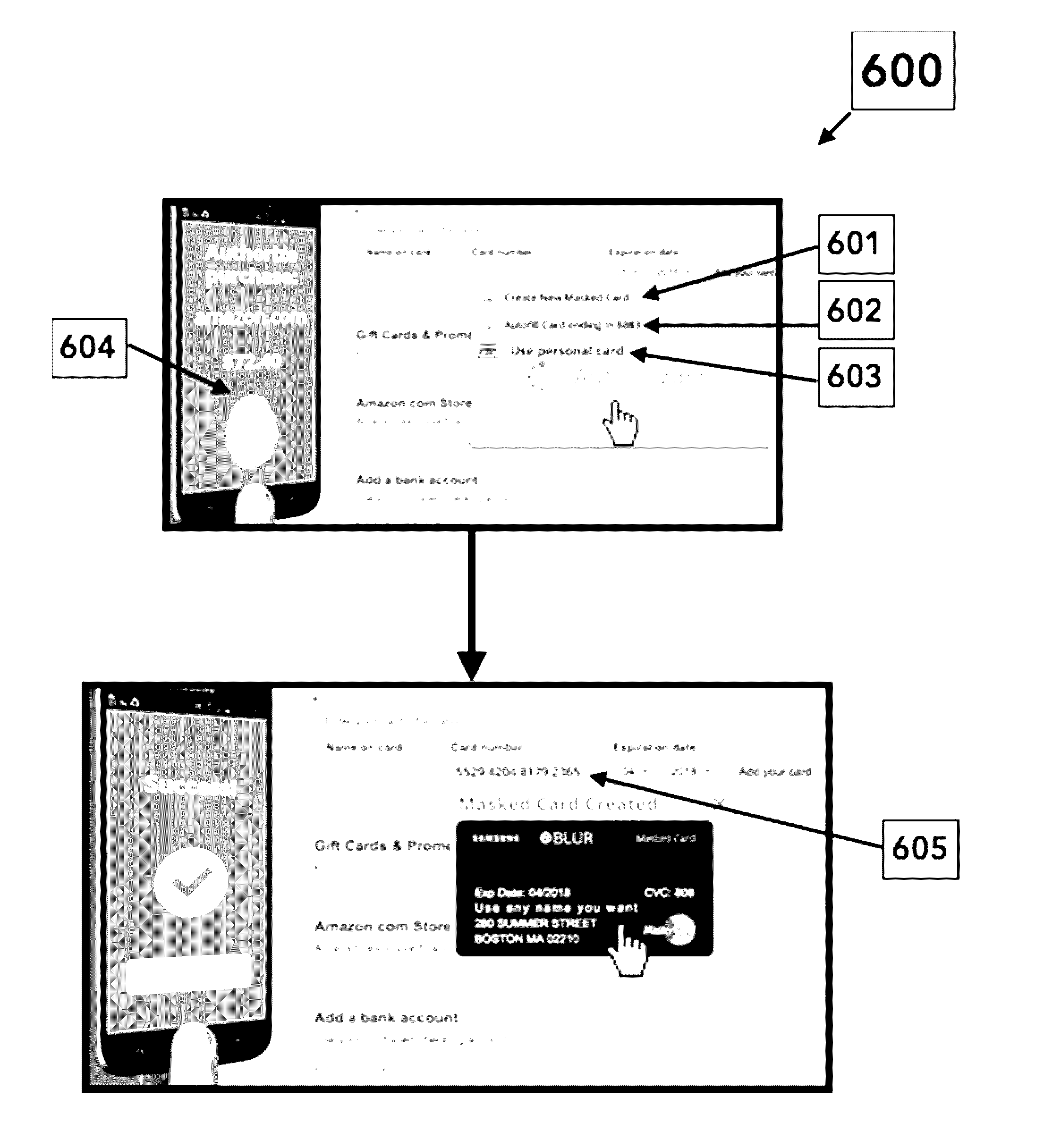

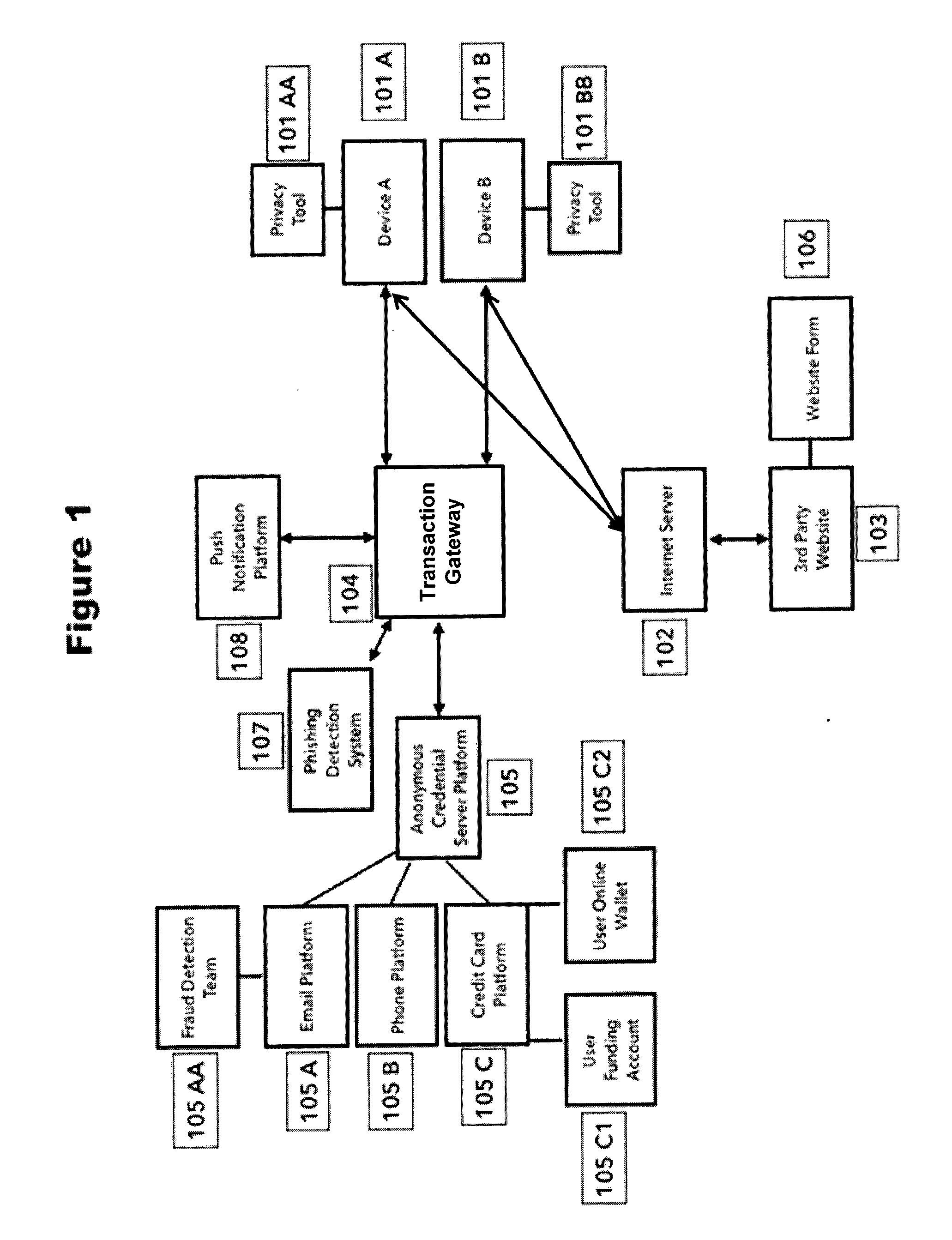

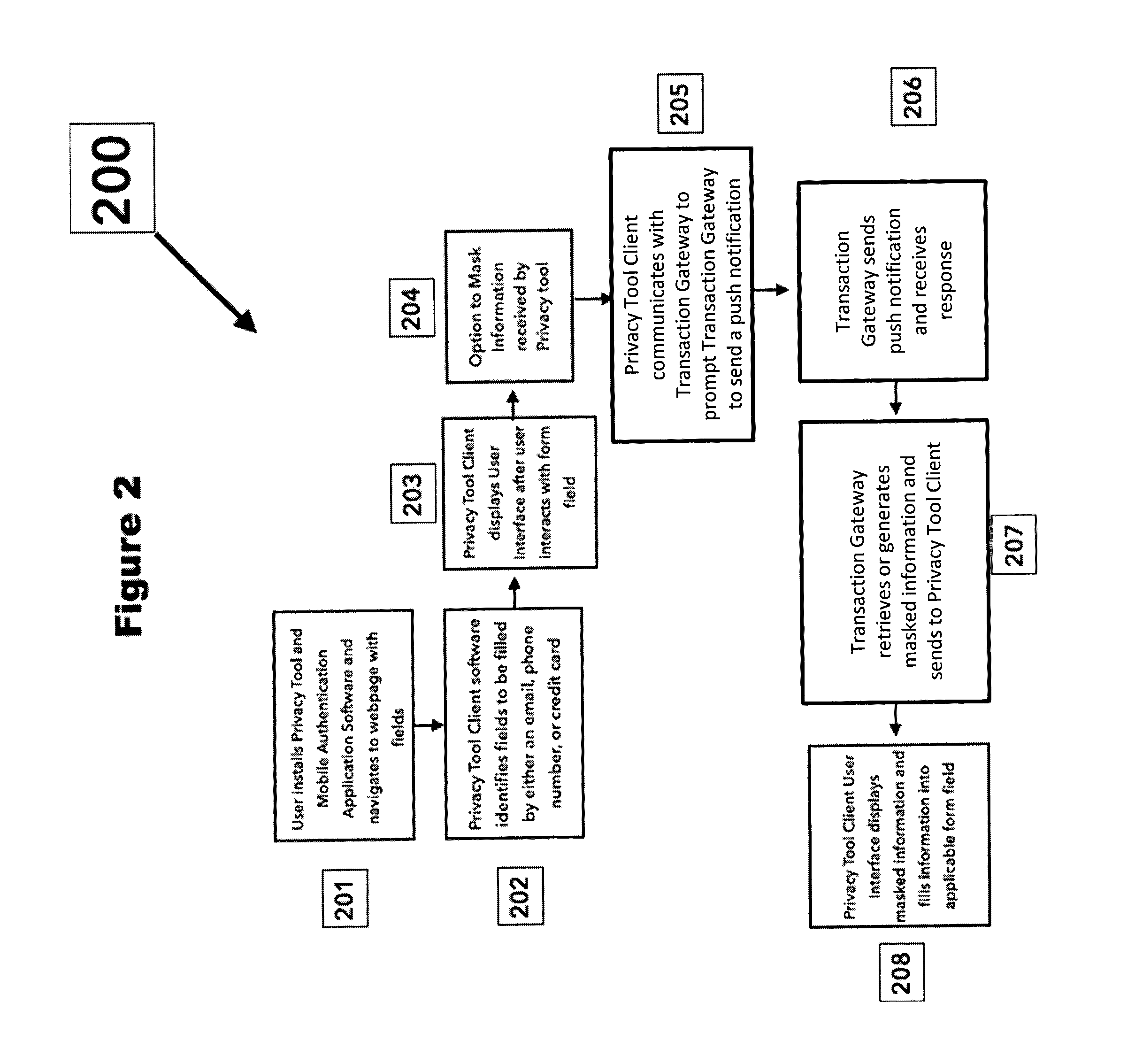

Push notification authentication platform for secured form filling

The present disclosure relates to systems and methods for notifying a user of attempts to provide masked credentials associated with the user to a third party, and for providing the user with an opportunity to approve or deny the attempt. The third party can be a website having a form field that receives the masked credential. The masked credential can include a telephone number, an email address, a mail address, a user name, a password, and funding account information (e.g., credit card or bank account numbers). Attempts to provide the masked credential using a device can be detected by an application installed on the device, and the notification can be implemented through a push notification sent to one or more devices registered with the user. Users can respond to the push notification by indicating whether the attempt to provide the masked credential is approved or denied.

Owner:IRONVEST INC

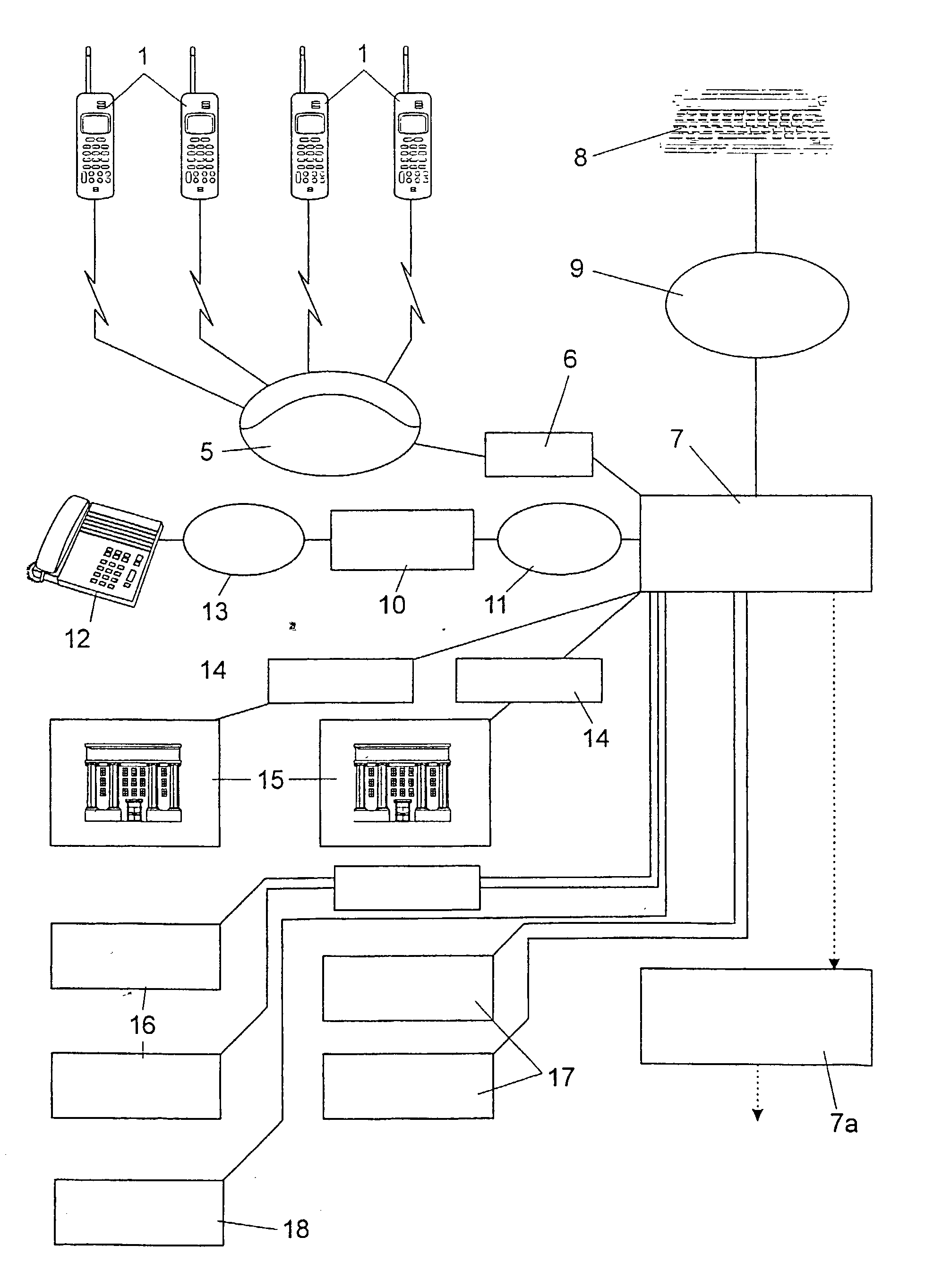

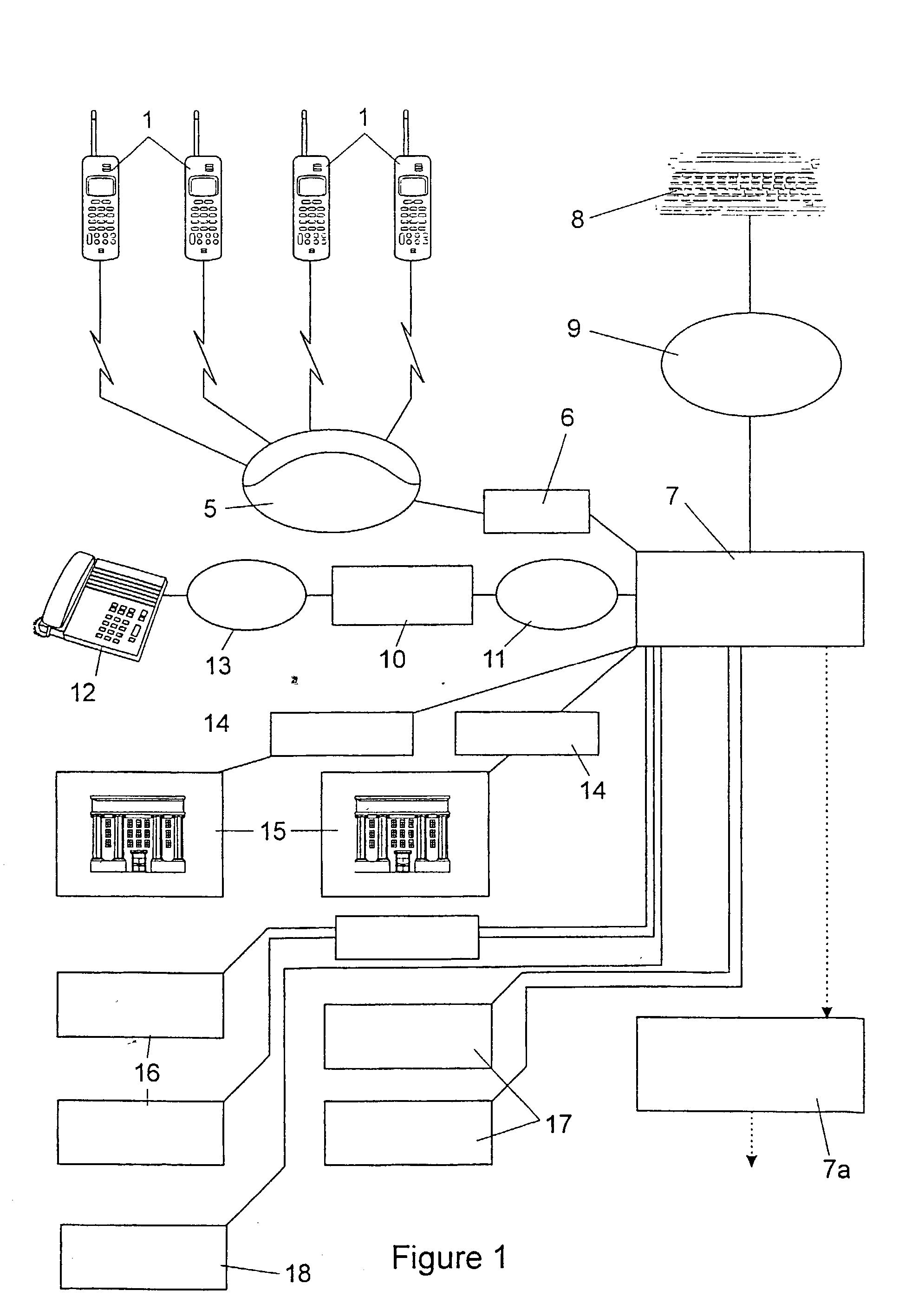

Banking system with enhanced identification of financial accounts

A computer based banking system is provided in which at least selected clients termed participating system members have access to a remote device adapted to communicate with the computer base banking system such that financial transactions can be conducted by remote operation of the remote device by the participating system member to result in the debiting of a financial data base record associated with an instructing participating system member and in the crediting of a different financial data base record. Each data base record is identified by a conventional account number generated to conform to banking numbering standards as well as a linked communication number different from the relevant bank account number and composed of at least two component strings of numbers and / or letters, one of which is a number regionally unique to the participating system member, and the other of which is a bank identifying number unique to the particular bank at least on a regional basis. The communication number preferably also includes the two digit international dialing code; the telecommunications area code or the mobile operator code; and a check digit.

Owner:FUNDAMO

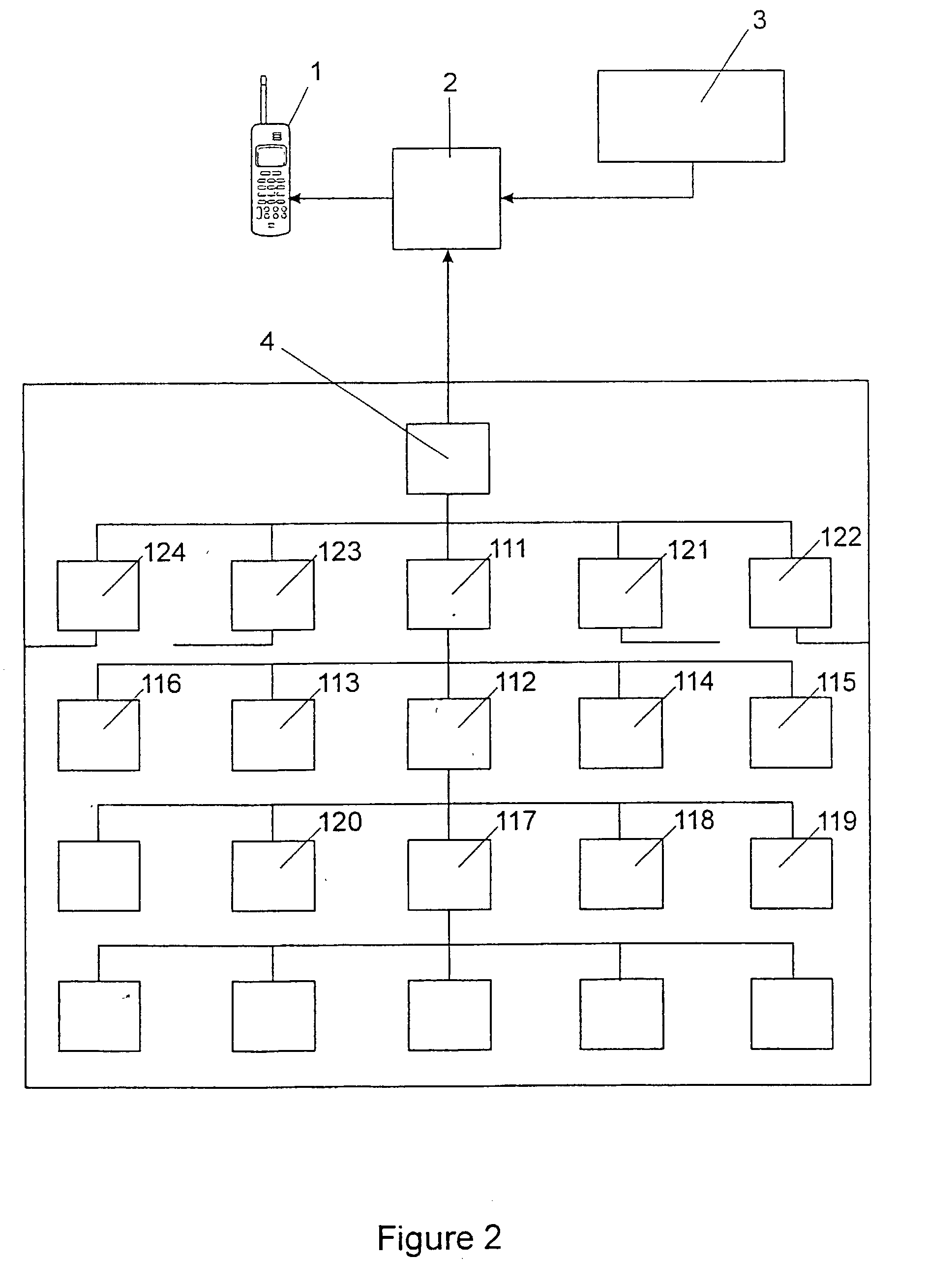

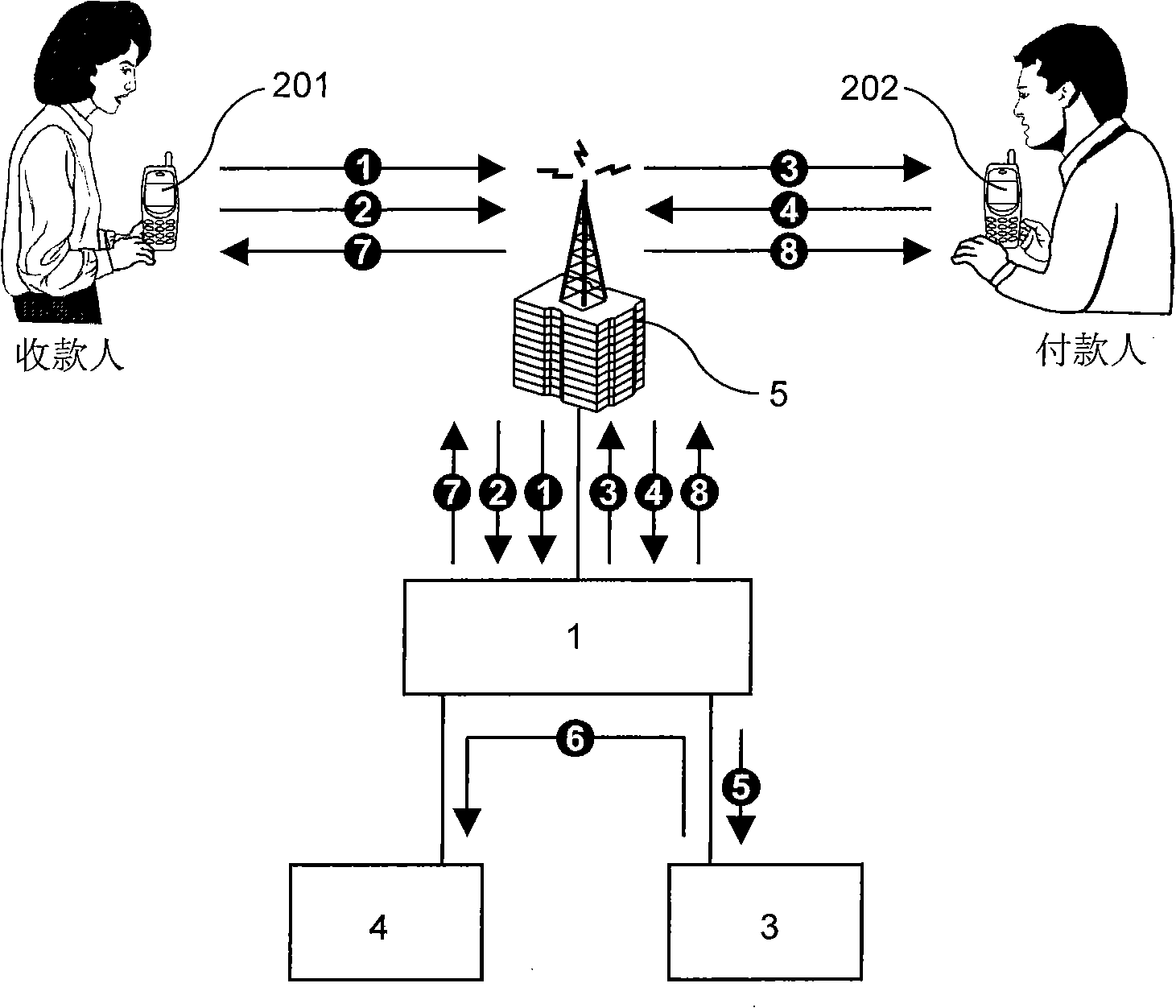

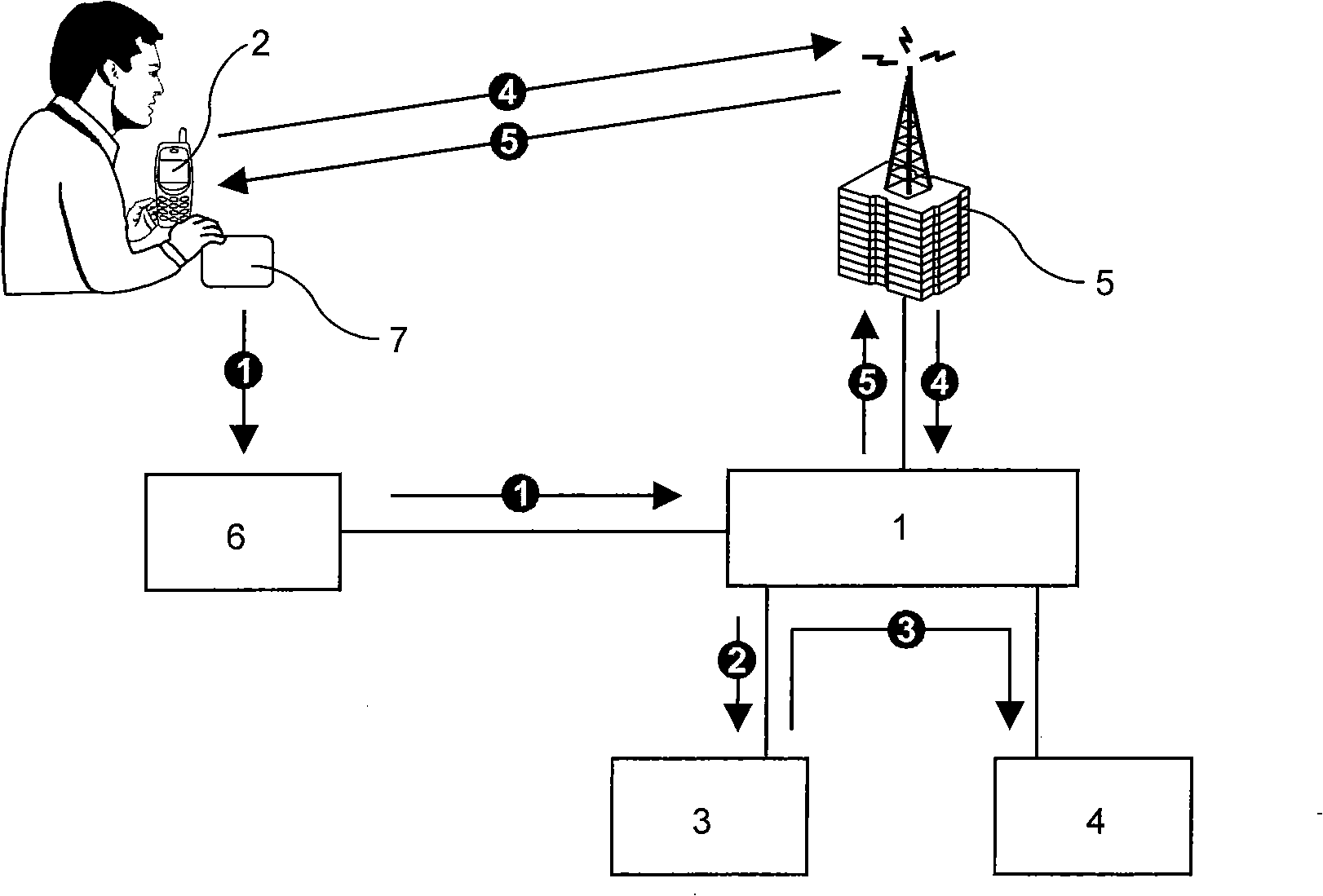

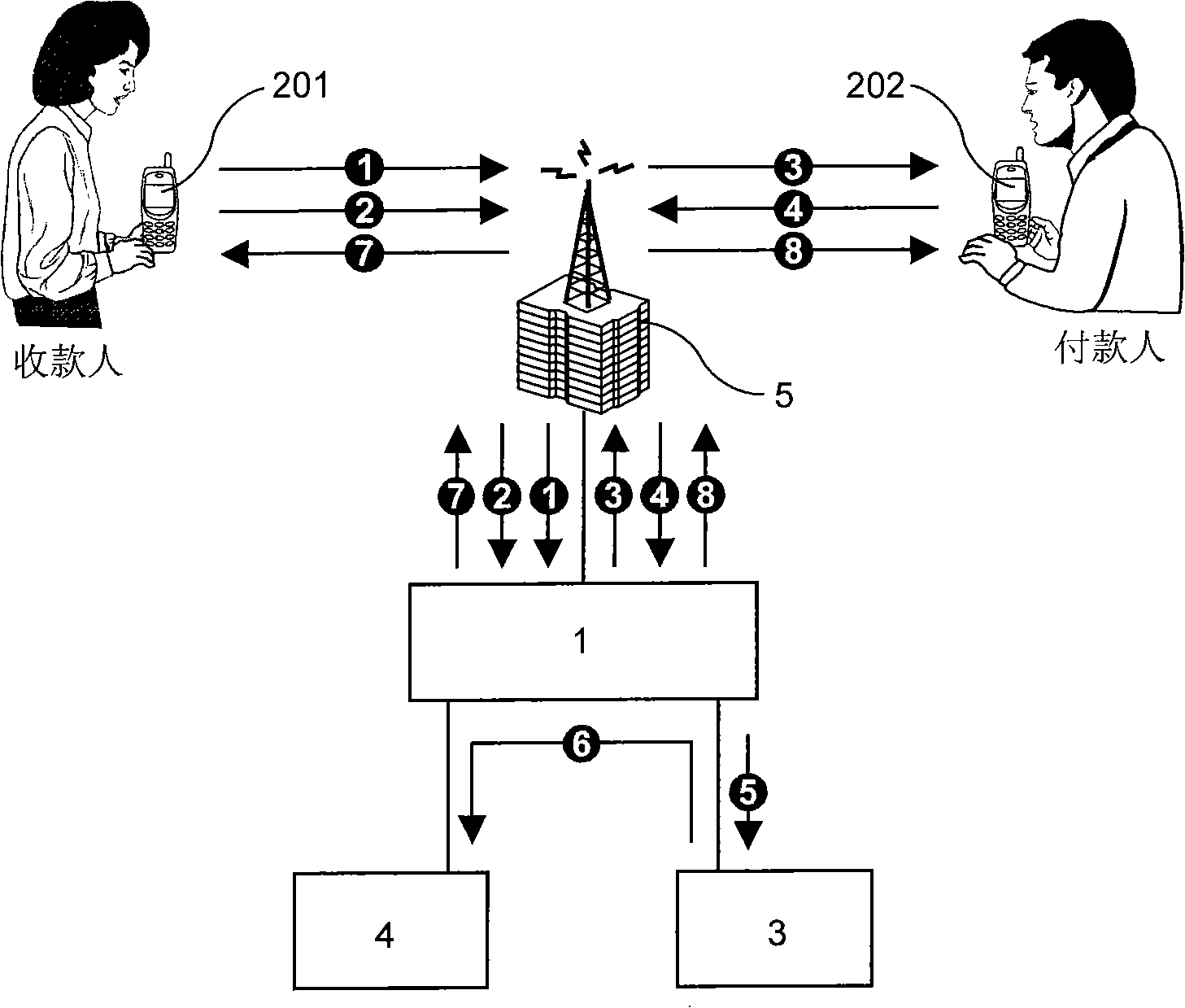

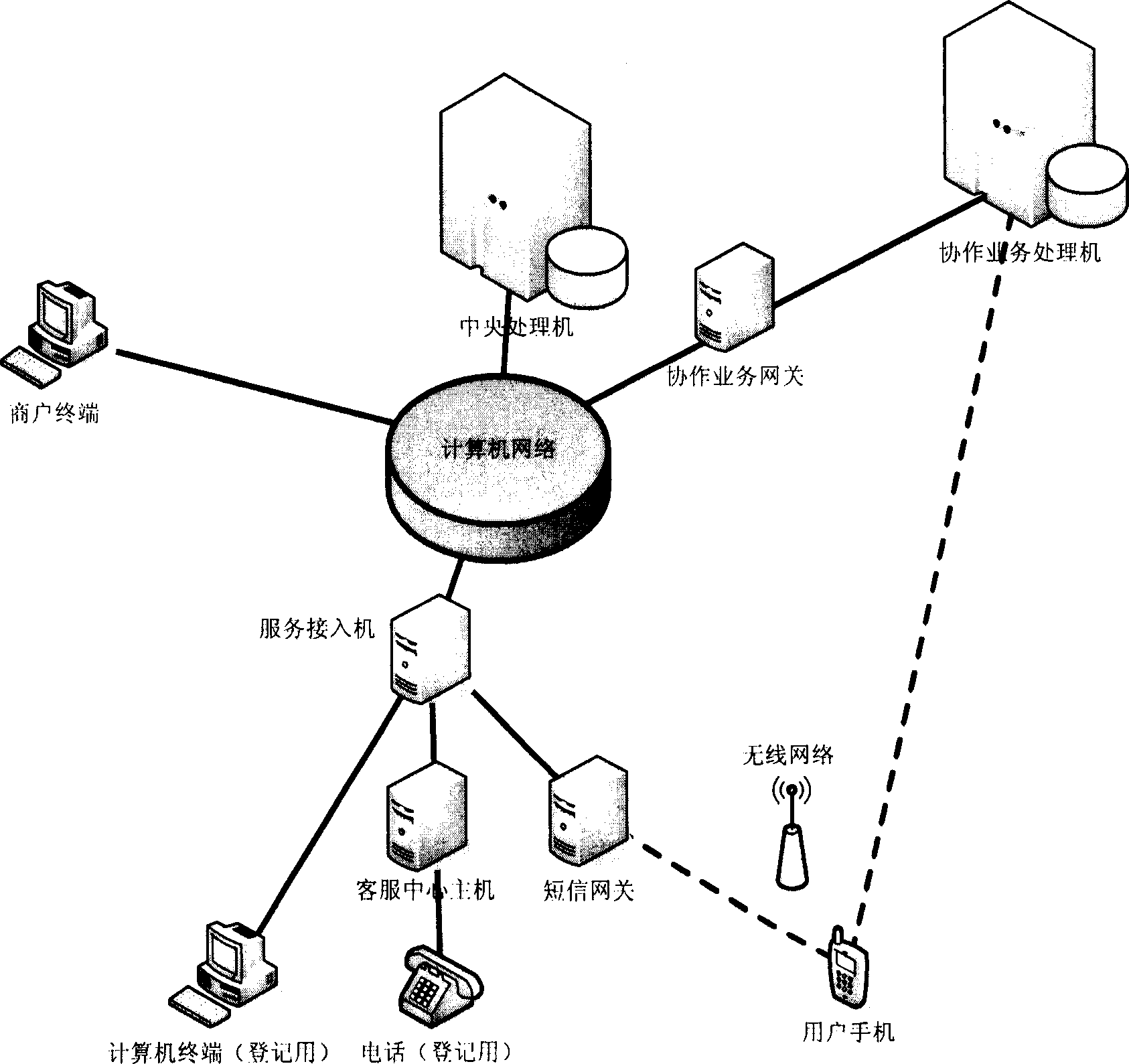

Method and system for payment in instant mutual bank transfer by mobile phone

The invention relates to a method of payment by mutual account transfer through mobile phones and a system thereof. A payee and a payer in advance package each bank account number with each mobile phone number in an account transfer center(1), after setting each payment password, the payee sends collection request information to the account transfer center(1) by a mobile phone(201) thereof during the payment by account transfer, the payer sends payment request information to the account transfer center(1), and after the account transfer center(1) reviews the collection request information of the payee and the payer checks that the payment request information is correct, the amount required in the payment request information is transferred from the bank account packaged with the mobile phone of the payer to the bank account packaged with the mobile phone of the payee. The method is characterized in that the payee and the payer can transfer account at any time and any place, and only by carrying out relative operation by mobile phone(2), money in the bank account of the payer can be transferred into the bank account of the payee.

Owner:黄金富

Method and apparatus for protecting account numbers and passwords

ActiveUS8738934B2Digital data processing detailsUnauthorized memory use protectionPasswordBank Account Number

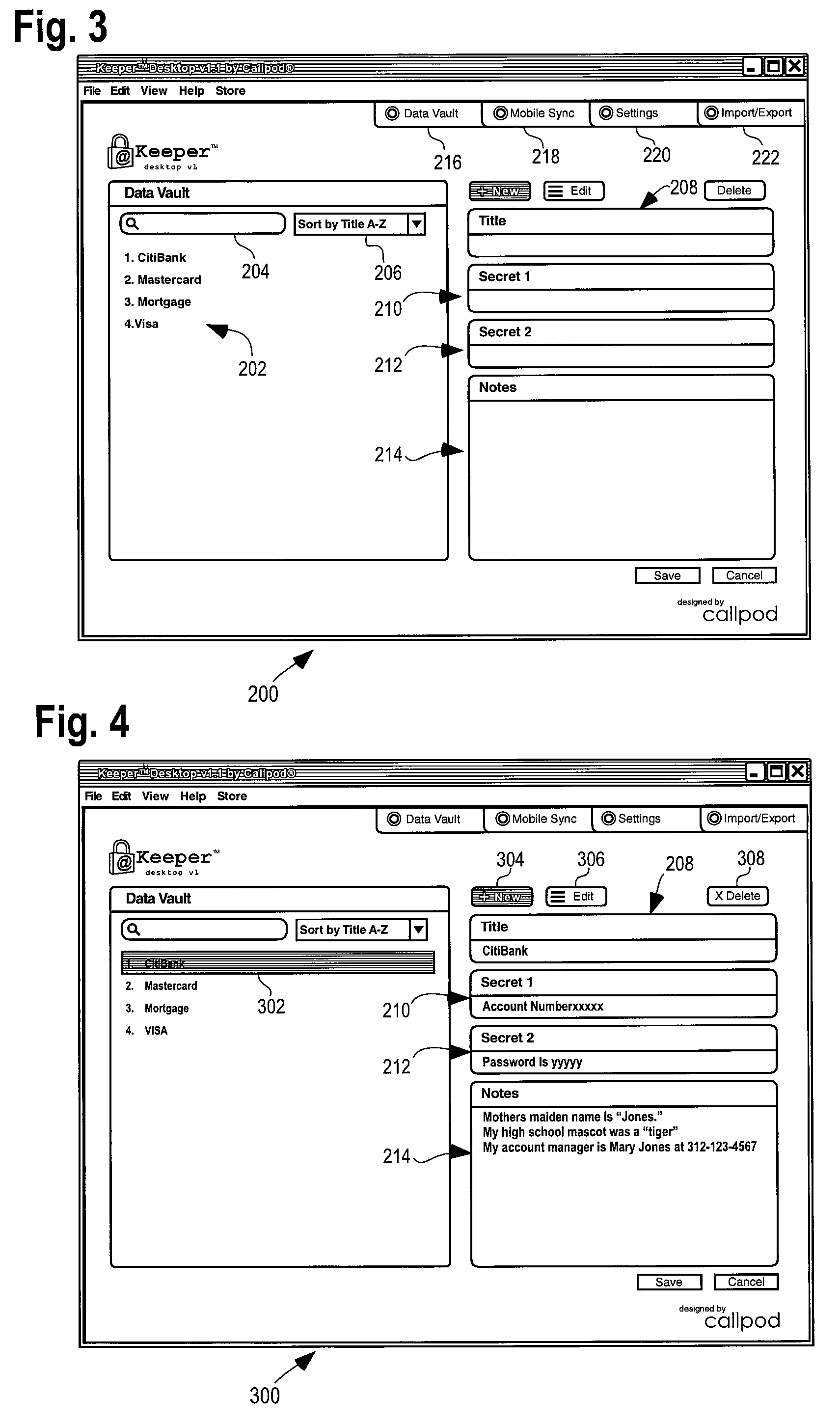

A method and apparatus are provided for protecting confidential information. The method includes the steps of providing a plurality of files where each file contains at least one item of secret information, such as a password for a private account. Access to the plurality of files is password protected with a master password. To access the plurality of files, the master password must be entered into a master password entry field. The files are deleted upon successive entry of incorrect passwords into the master password entry field a predetermined number of times.

Owner:KEEPER SECURITY

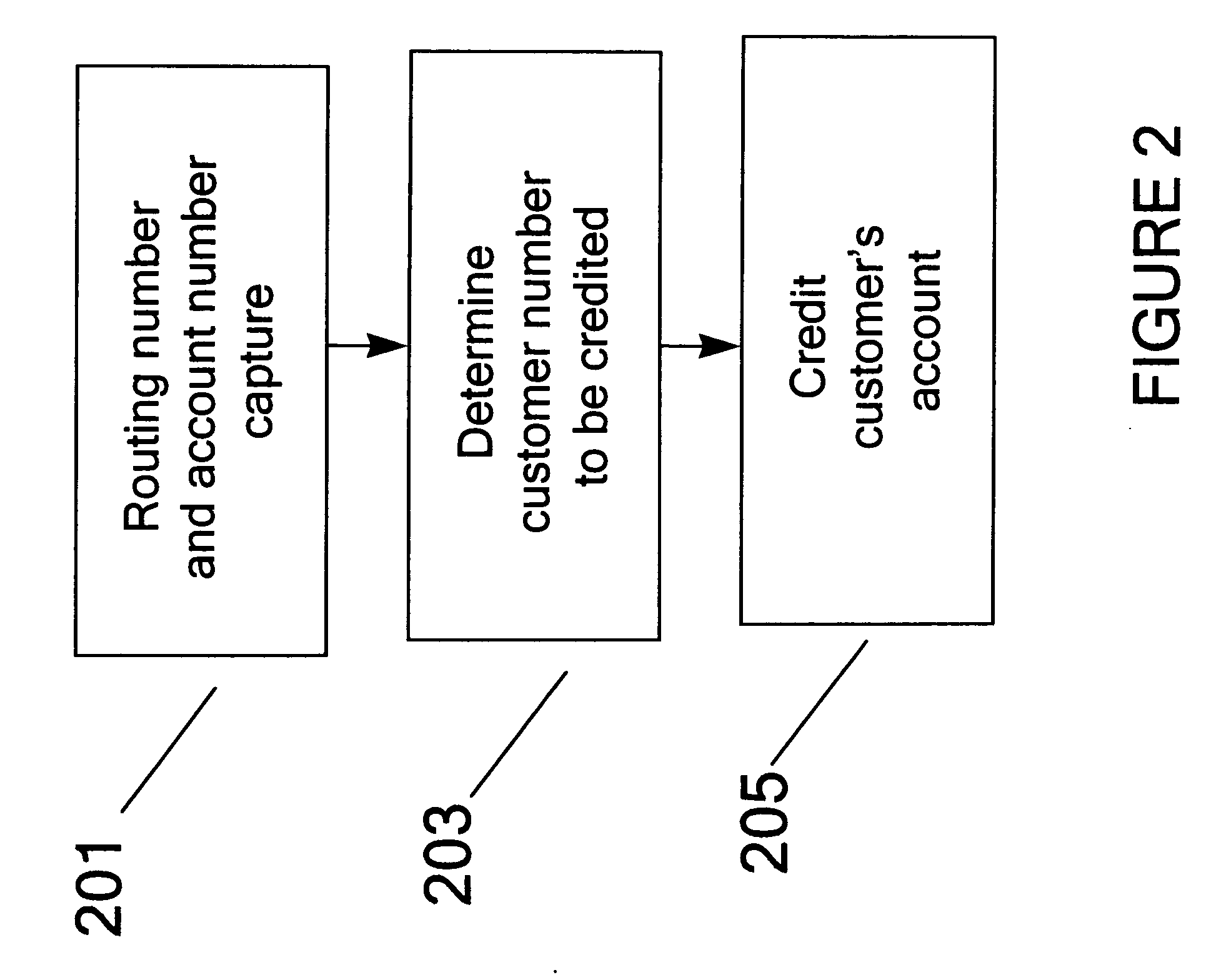

Method, system, and program product for resolving unmatched payments

Owner:GEORGE JAMES GRANT

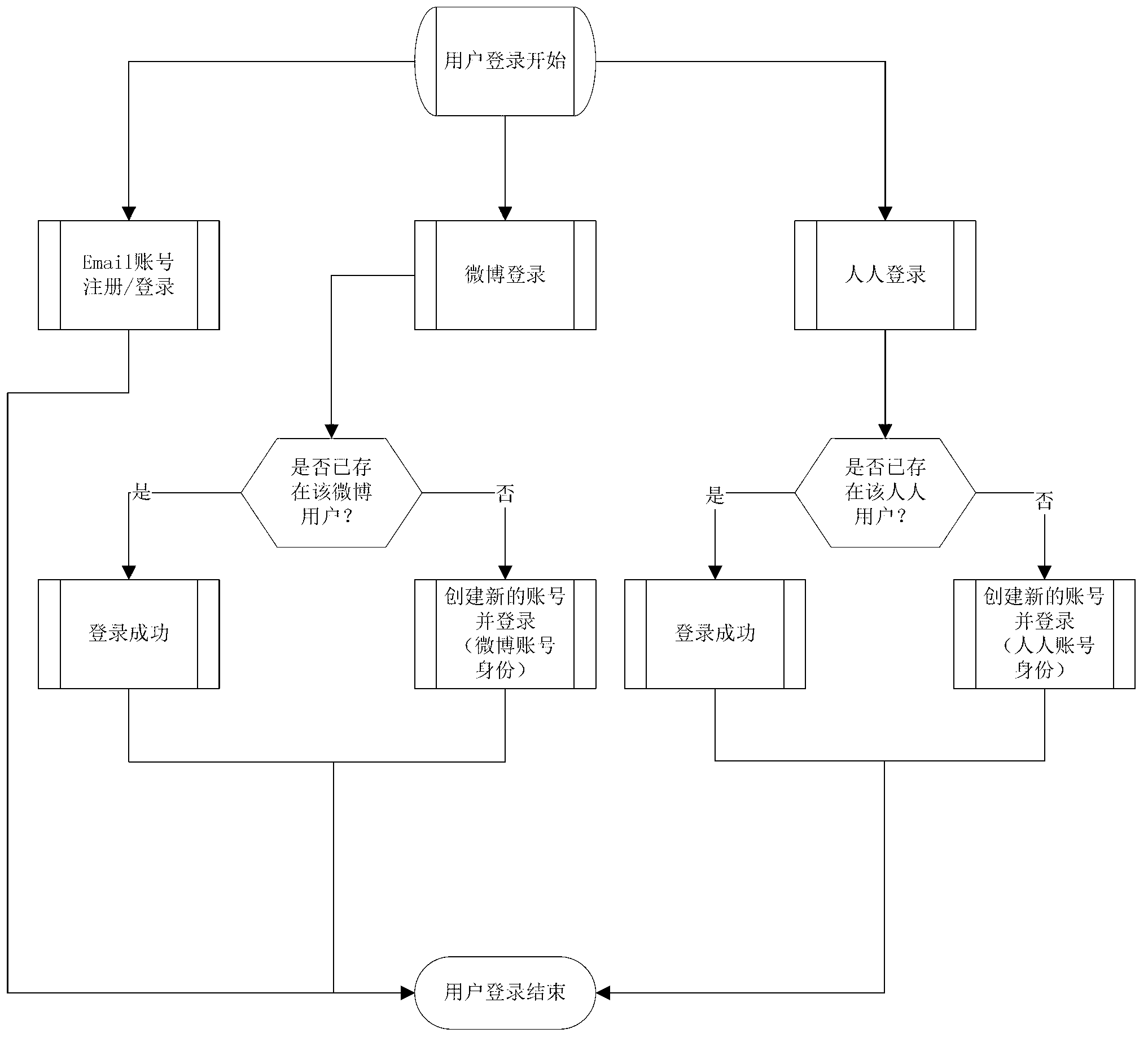

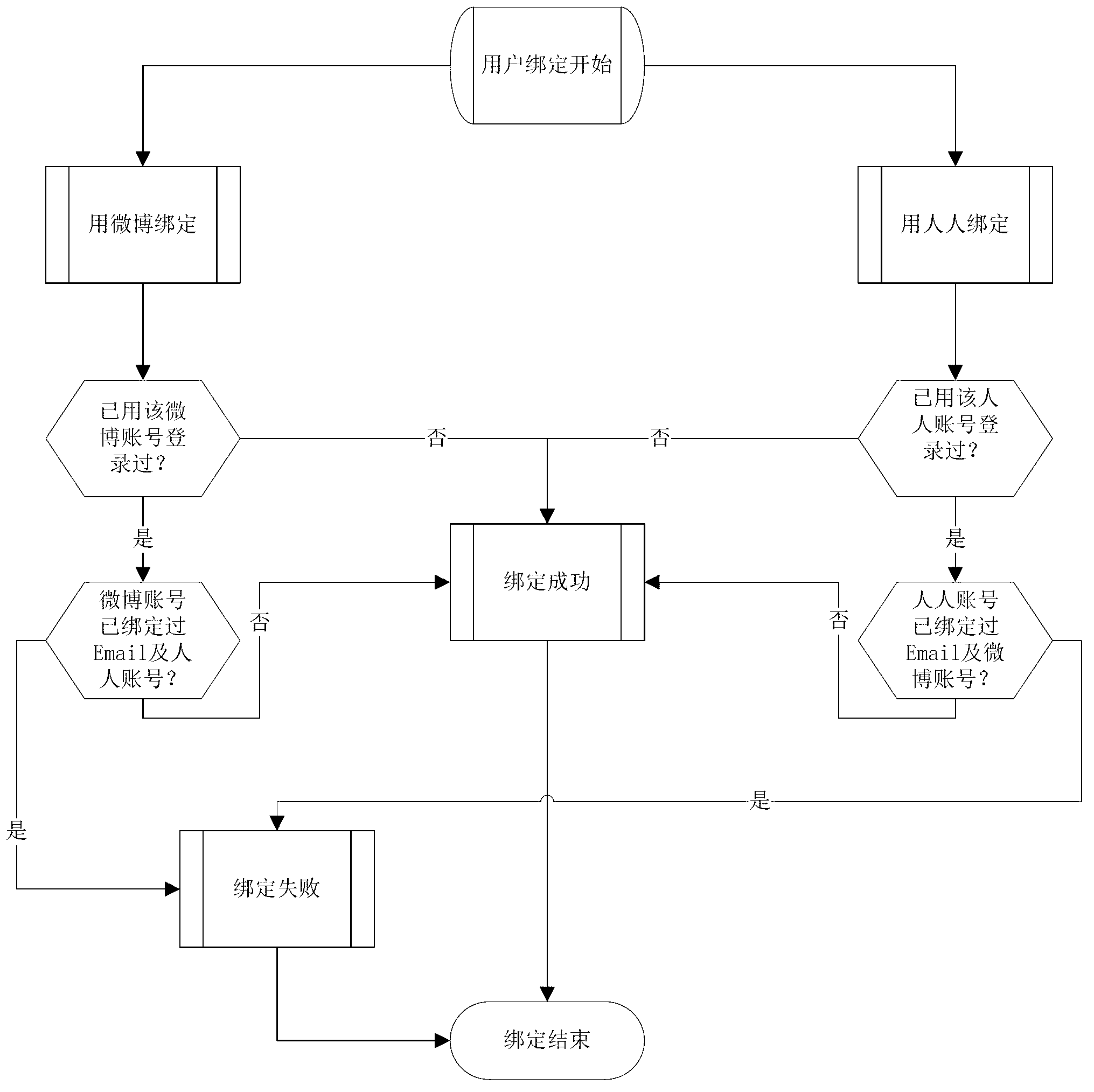

Method for combining account number of platform system and account number of third party system in computer system

InactiveCN103268233ARealize binding and intercommunicationEnsure binding interoperabilitySpecific program execution arrangementsThird partySoftware system

The invention relates to a method for realizing combined management of the login account number of a platform system and the account number of a third party system in a computer software system. The method comprises user account number registration processing operation and user account number binding processing operation, wherein the information of a plurality of user accounts is subjected to combined management, so that the combined integrated information can be seen when any one account is registered. By virtue of the method for realizing combined management of the login account number of the platform system and the account number of the third party system in the computer software system, a plurality of third part accounts are bound into one account, the plurality of accounts can be registered together, the same result is seen after registration, and data of binding accounts and bound accounts is combined during binding, so that data share is realized, the same combined information can be seen when any one account is registered, multi-account registration is realized, multi-account binding intercommunication is guaranteed, the processing process is quick and convenient, the work performance is stable and reliable, and the application range is wide.

Owner:SAFY INFORMATION TECH SHANGHAI

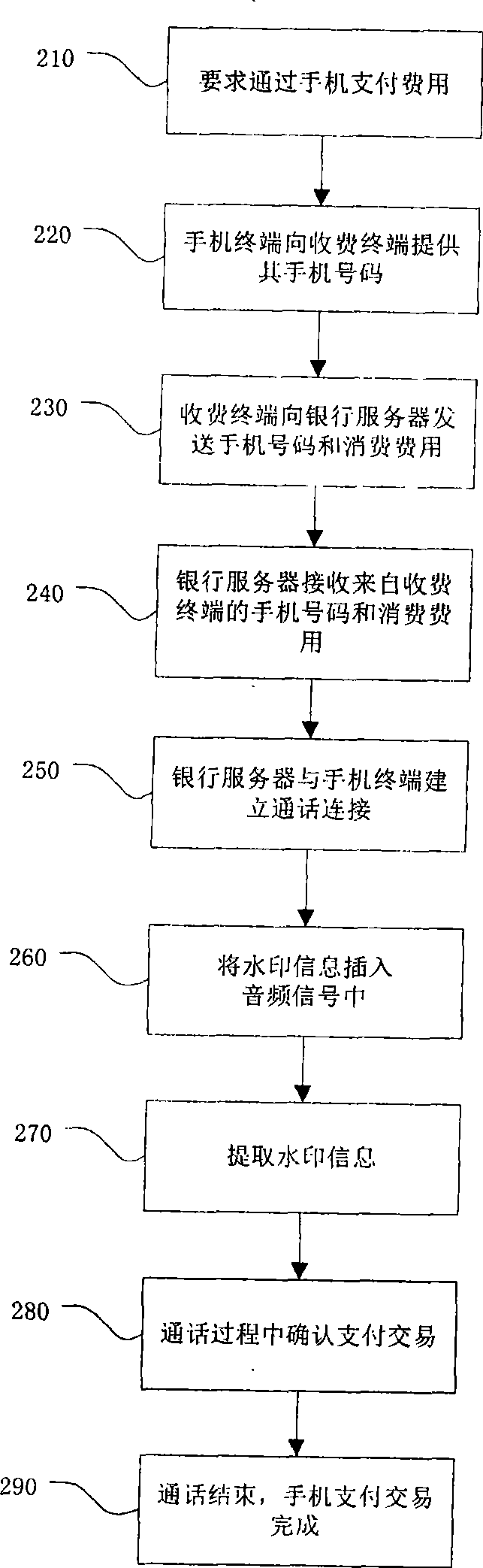

Mobile phone payment authentication system and method based on audio watermark

InactiveCN101464982AEnsure safetySolve the problem of poor immediacyAccounting/billing servicesPayment architectureTelecommunicationsAudio watermark

The invention relates to an audio-frequency watermark technology, which particularly relates to a mobile phone payment authentication system and a method thereof based on audio-frequency watermark. The mobile phone payment authentication system is characterized in that private information of mobile phone terminal users is inserted into the mobile phone terminal as watermark in audio signal transmitted to a bank server; and the private information of users as watermark is extracted from audio signal with watermark in the bank server. The watermark information relates to the private information such as bank account numbers and passwords of the account numbers of the mobile phone terminal users. In the optimal embodiment of the invention, the mobile phone ID of mobile phone terminals is adopted as watermark information. In another optimal embodiment of the invention, the mobile phone terminals and the bank server have a confirmation function upon voice print. The mobile phone payment authentication system and the method thereof solve the problem of the mobile phone payment security of the mobile phone payment which is developed in a large scale is restricted. Therefore, the invention has the advantages of important application prospect and use value.

Owner:BEIJING KEXIN TECH

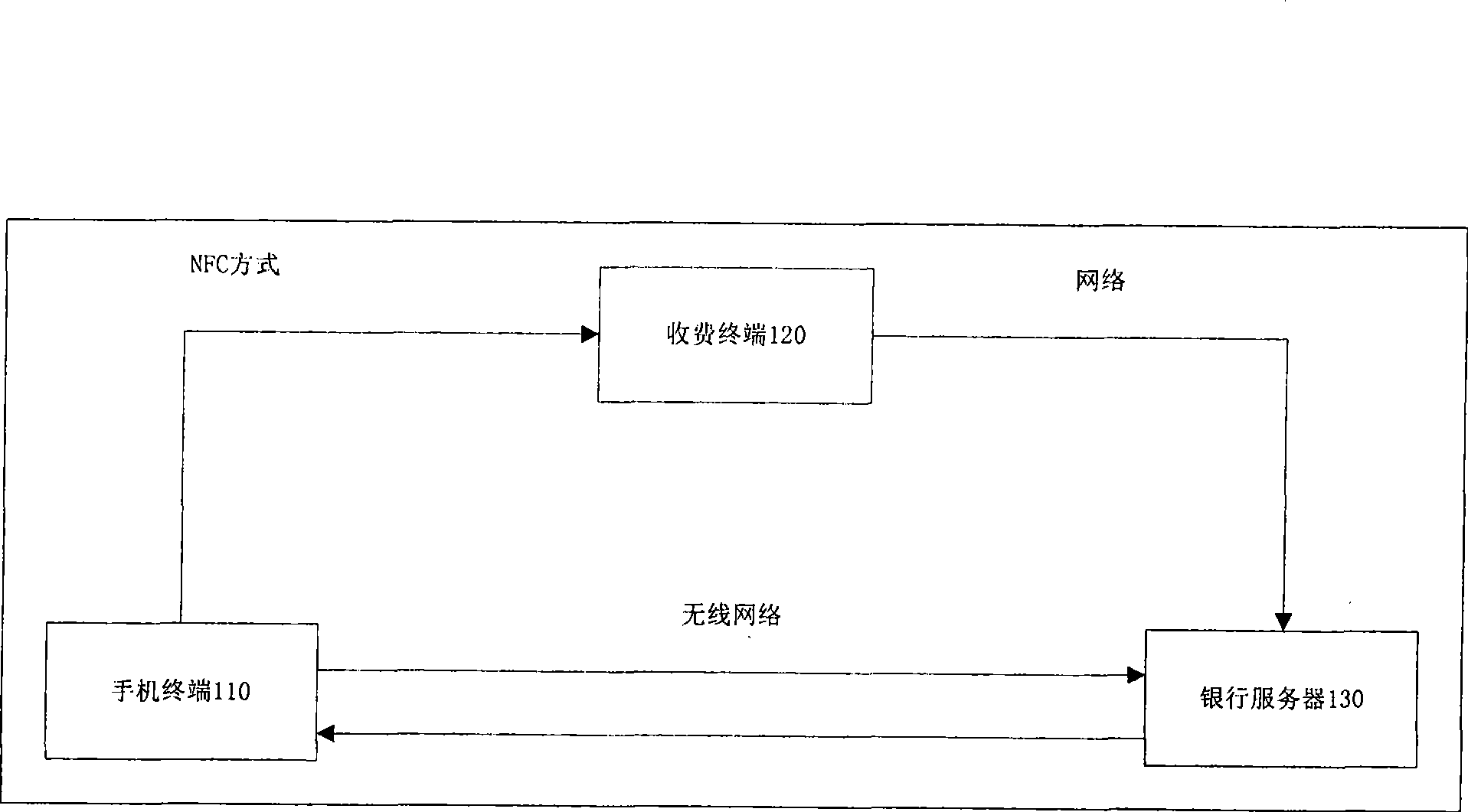

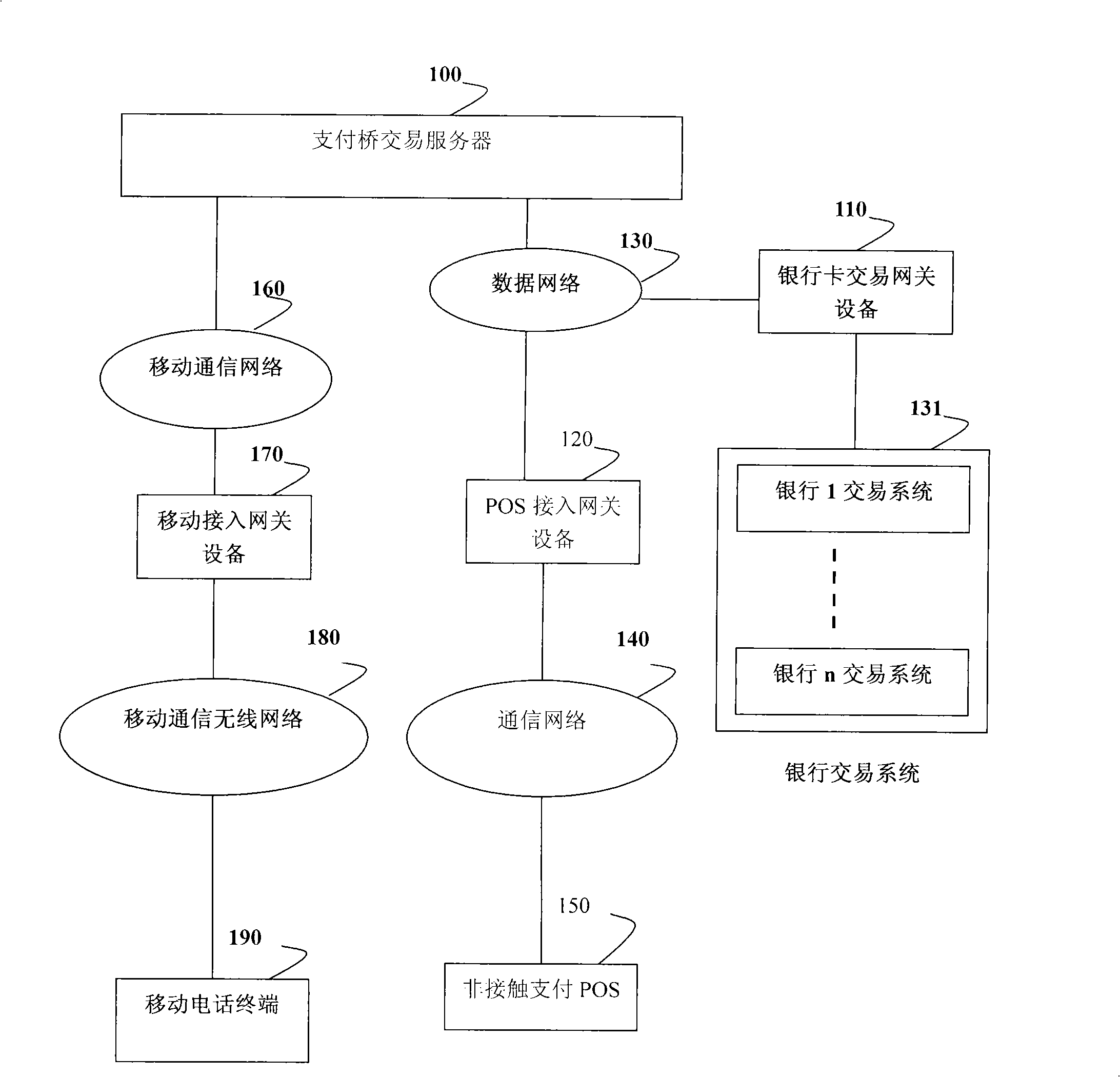

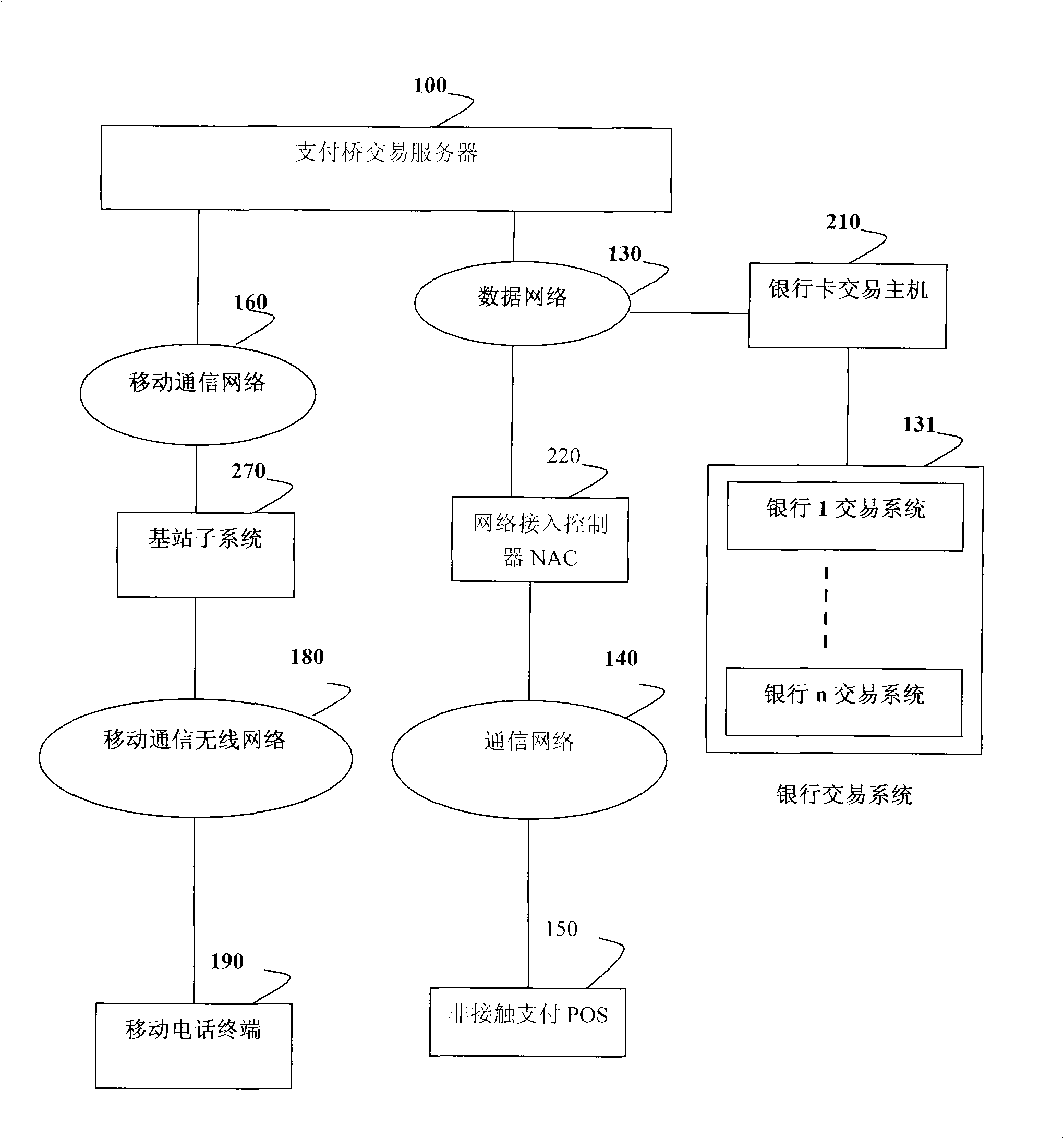

System and method for realizing non-contact payment based on payment bridge

The invention provides a system and a method for realizing non-contact payment based on a payment bridge. On-line payment service triggered by a non-contact payment identification code is provided by establishing the corresponding relation of the non-contact payment identification code and a bank deposit account A in a payment bridge transaction system, and a payment bridge transaction server is used to finish the transferred account service of the bank deposit account A corresponding to the non-contact payment identification code to a bank account number of a merchant, thereby ensuring that a mobile phone user can finish on-line payment through an RFID card or a two-dimensional code multimedia message.

Owner:候万春

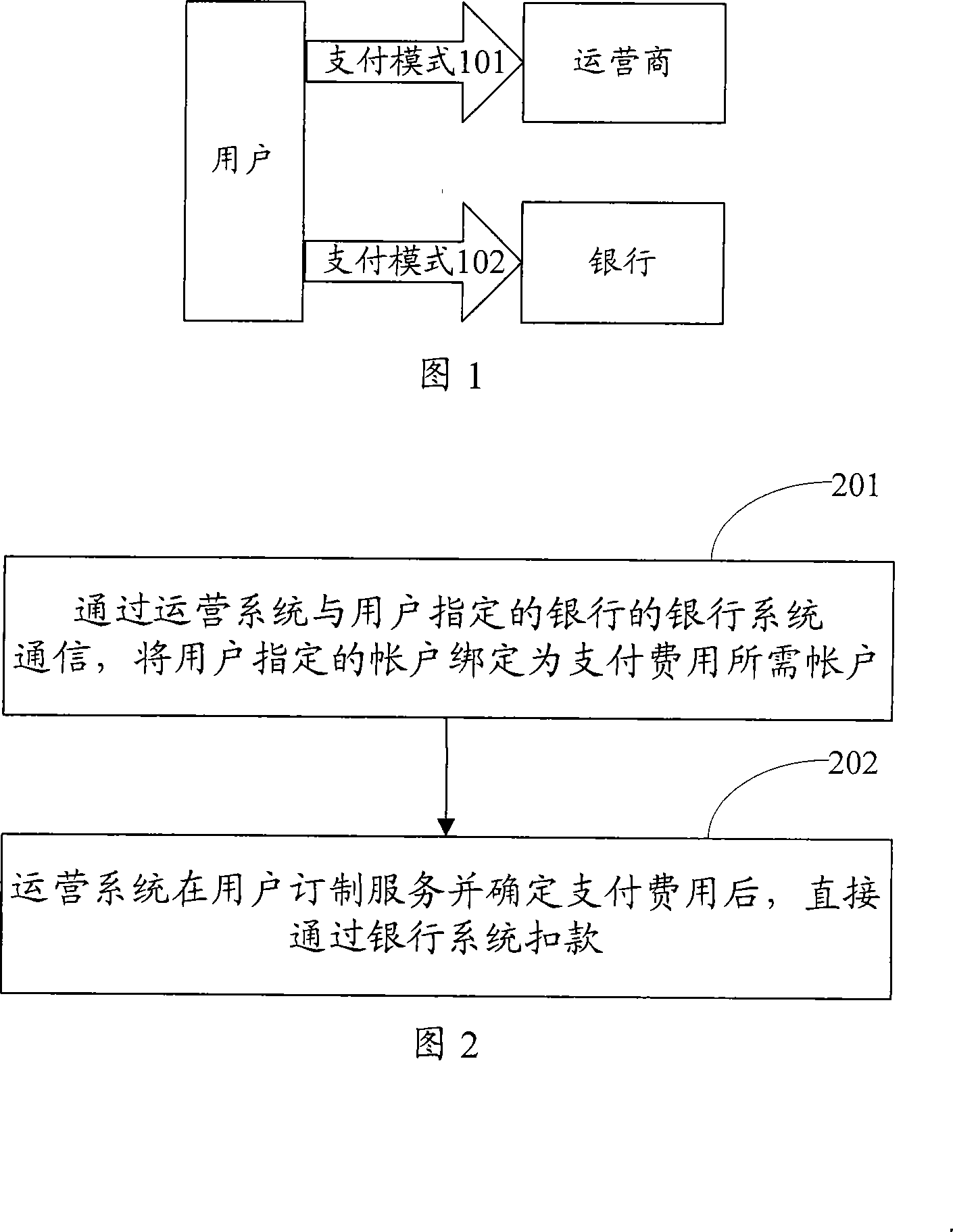

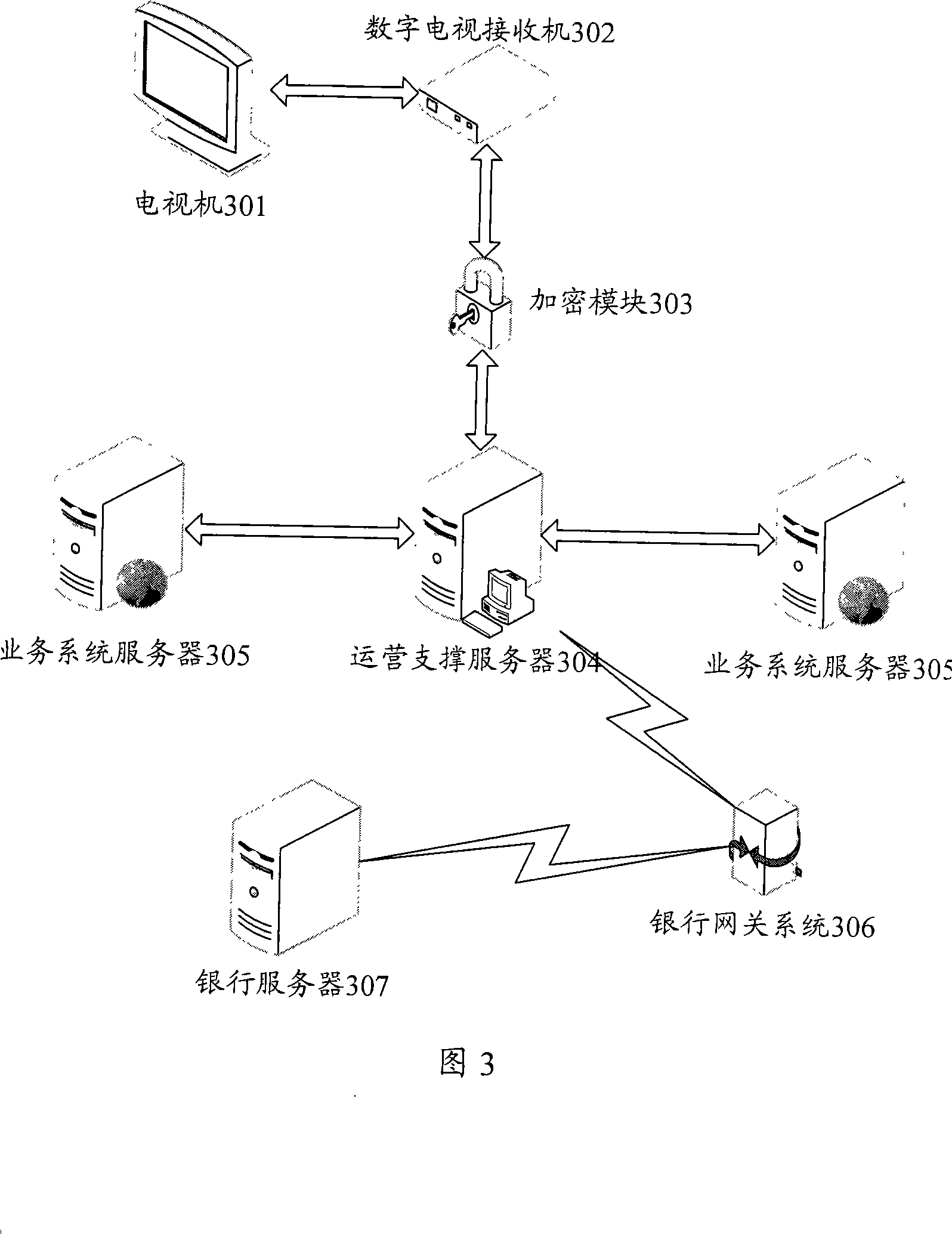

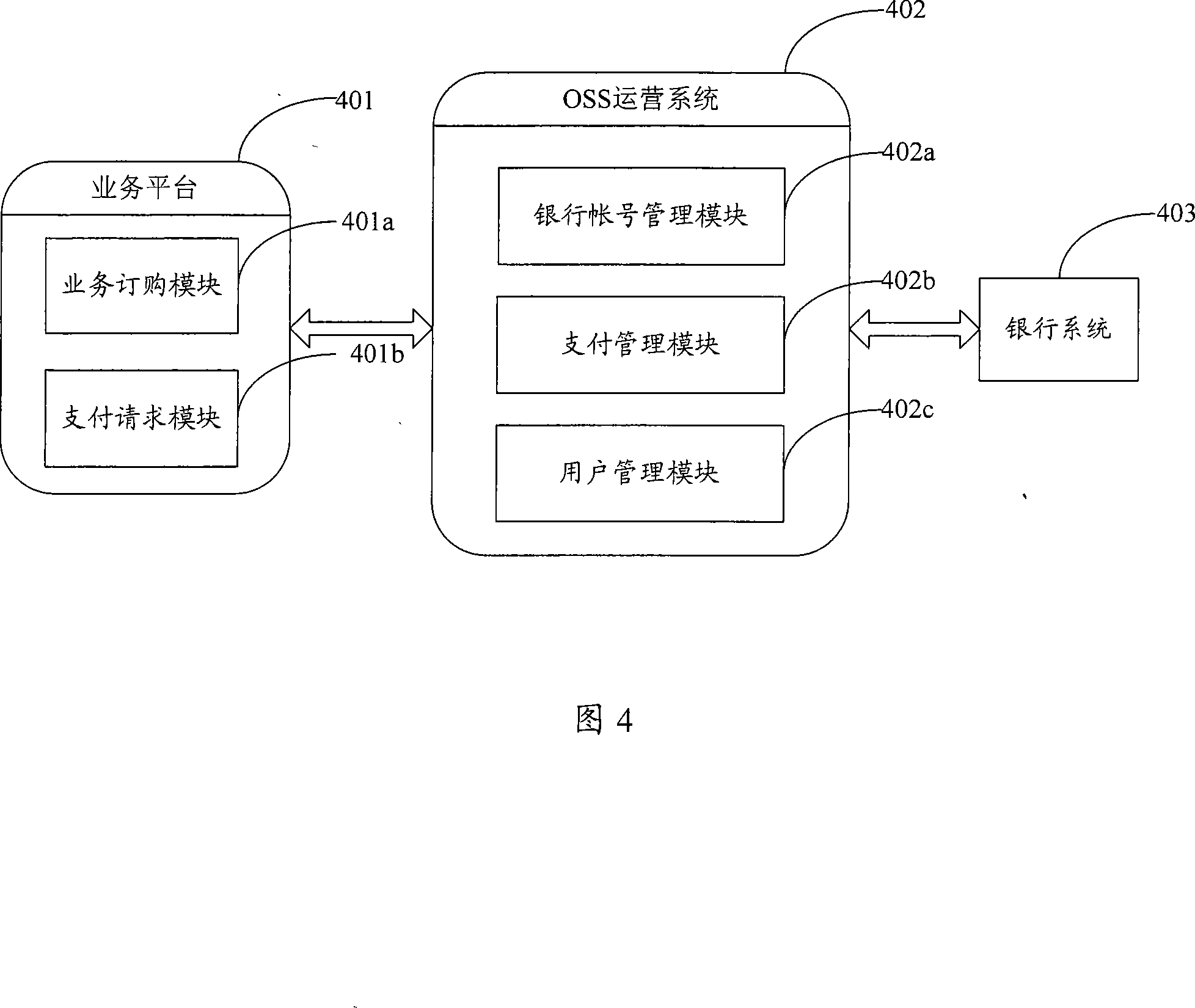

Server, transport operation system and paying method using digital television system

InactiveCN101207789AAnalogue secracy/subscription systemsPayment architecturePaymentComputer science

The invention provides a method, an operation system and an operation support server that the expenses are paid by utilizing a digital television system, and belongs to the digital television system field. An account appointed by a user is bound into an account required by the payment of the expenses by the communication between the operation system and a banking system of a bank appointed by the user; the operation system cuts payment by the banking system directly after the user customs the service and confirms the payment. The user can not only self-take out the account funds from the bound account, but also modify the bound account at will. The invention connects the user and the banking system by the operation system to realize the unification of the user, the operator and the banking management, binds the existing banking account of the user and increment operation service, and realizes the payment of the application expense of the operation by the banking system, thereby solving the difficulties of difficult management and inconvenient use when the user sets up different accounts aiming at different operations.

Owner:SHENZHEN LONG VISION

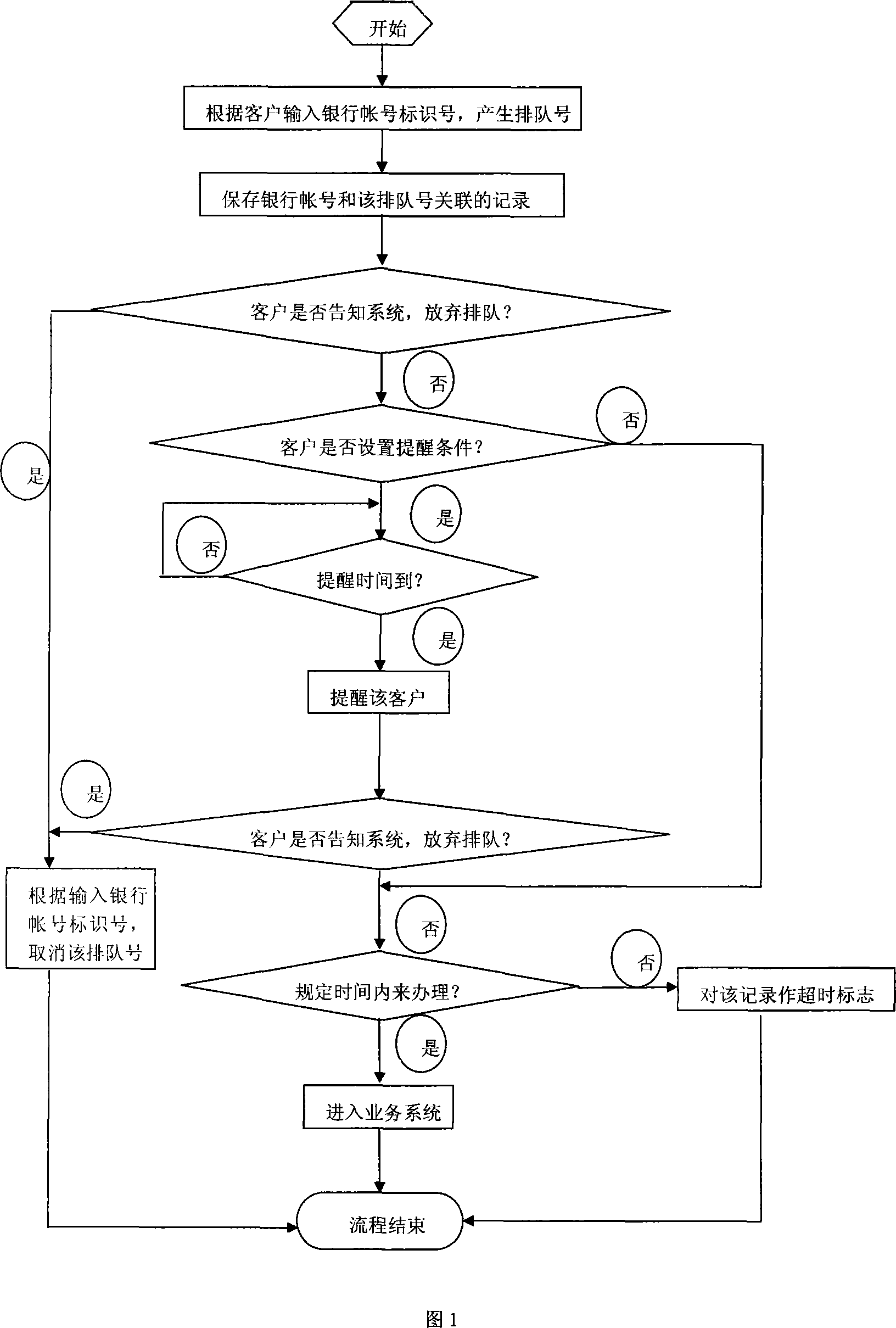

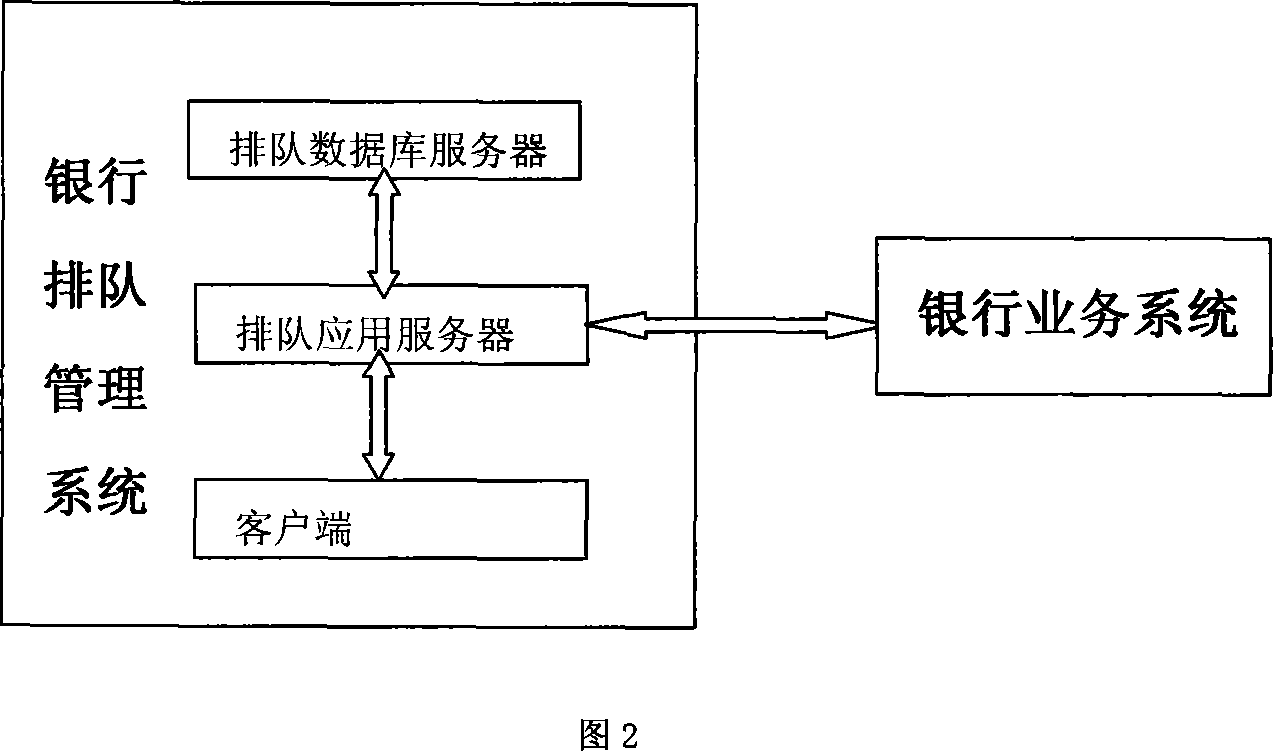

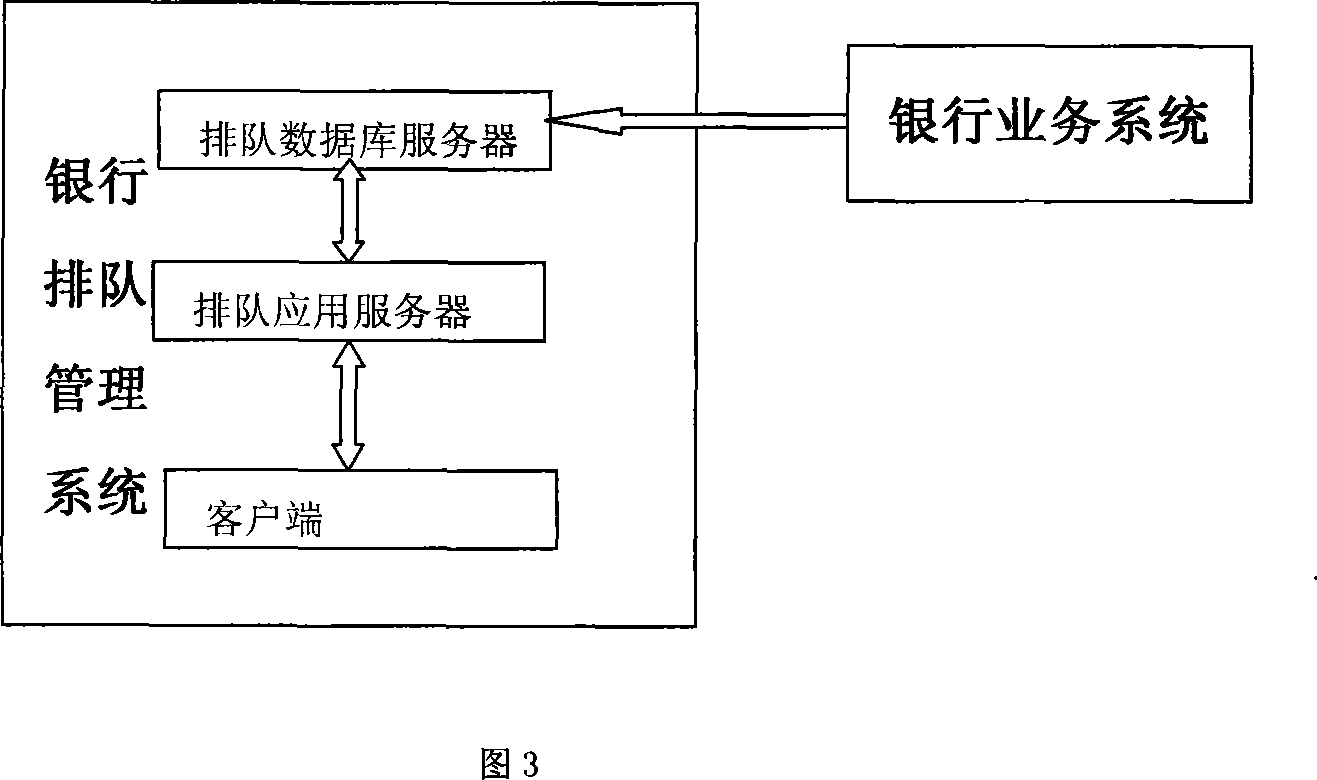

A service account number-based queue method

A queue method based on back account uses bank account mark number as reference of the queue number, to generate a queue number according to the account mark number input by client, wherein the account mark number is relative to the bank account, which can be positioned to one unique back account. A queue manage system stores the record of the relation between the bank account and the queue number, and when client withdraws the queue, the client can based on the account mark number inform the queue manage system to eliminate the queue number, and when client is delay, the queue information can be changed to move back the real serial number in the queue, to save time. And client can set a plurality of prompts, to be processed in met condition by the system. And when the client without eliminated queue dose not process relative service, the queue manage system records an overtime mark on the record between the bank account and the queue number, to accelerate the queue elimination of client to inform the queue manage system.

Owner:郑志豪

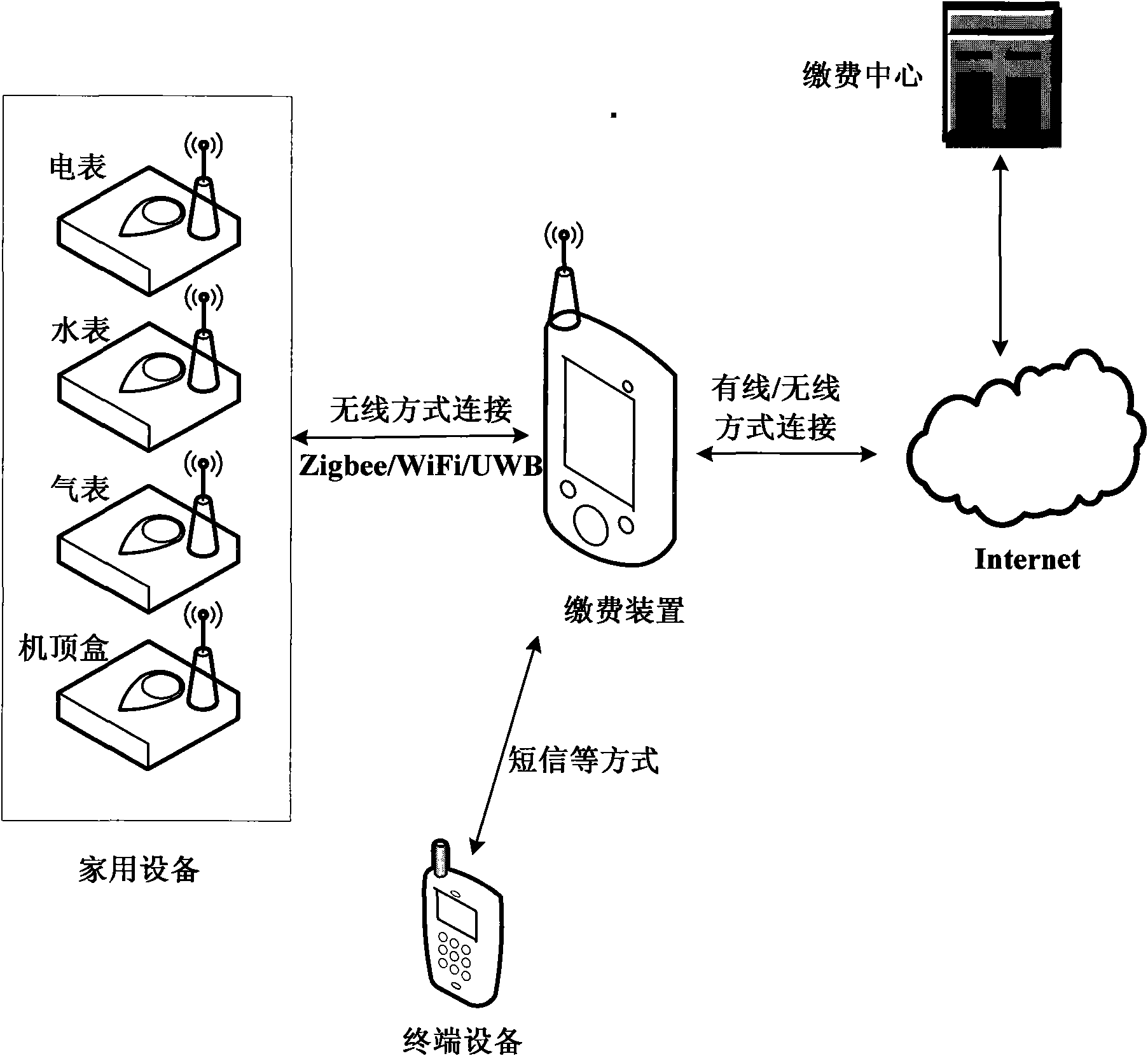

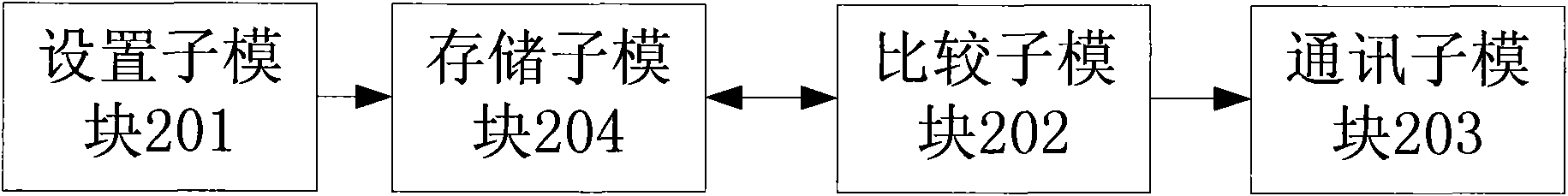

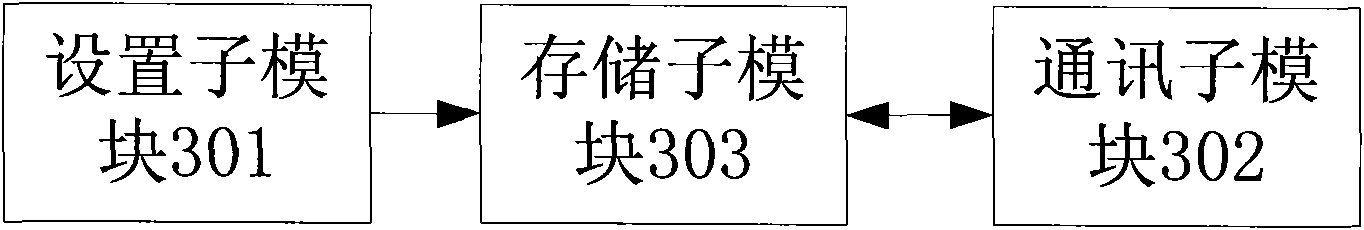

Prepayment domestic equipment, payment method thereof, payment system thereof and payment device thereof

InactiveCN101931579AShorten the timeImprove practicalityMetering/charging/biilling arrangementsData switching by path configurationPasswordCIPURSE

Owner:ZTE CORP

Banking system controlled responsive to data bearing records

A banking system operates to allocate funds in accounts in response to data bearing records in the form of paper financial checks. A mobile phone has a camera and a programmable memory. The memory stores phone user data, including a bank account number and an electronic signature. The camera can be used to capture an image of a paper check which has the phone user as the payee. The phone can wirelessly transmit the account number, the electronic signature, and the check image to a bank deposit system. The system can store the check image and the electronic signature in correlated relation in a deposit transaction record. The system can cause the phone user's bank account to be credited a cash value corresponding to the check value. Confirmation of the check deposit can be transmitted to the user's phone.

Owner:DIEBOLD SELF SERVICE SYST DIV OF DIEBOLD NIXDORF INC

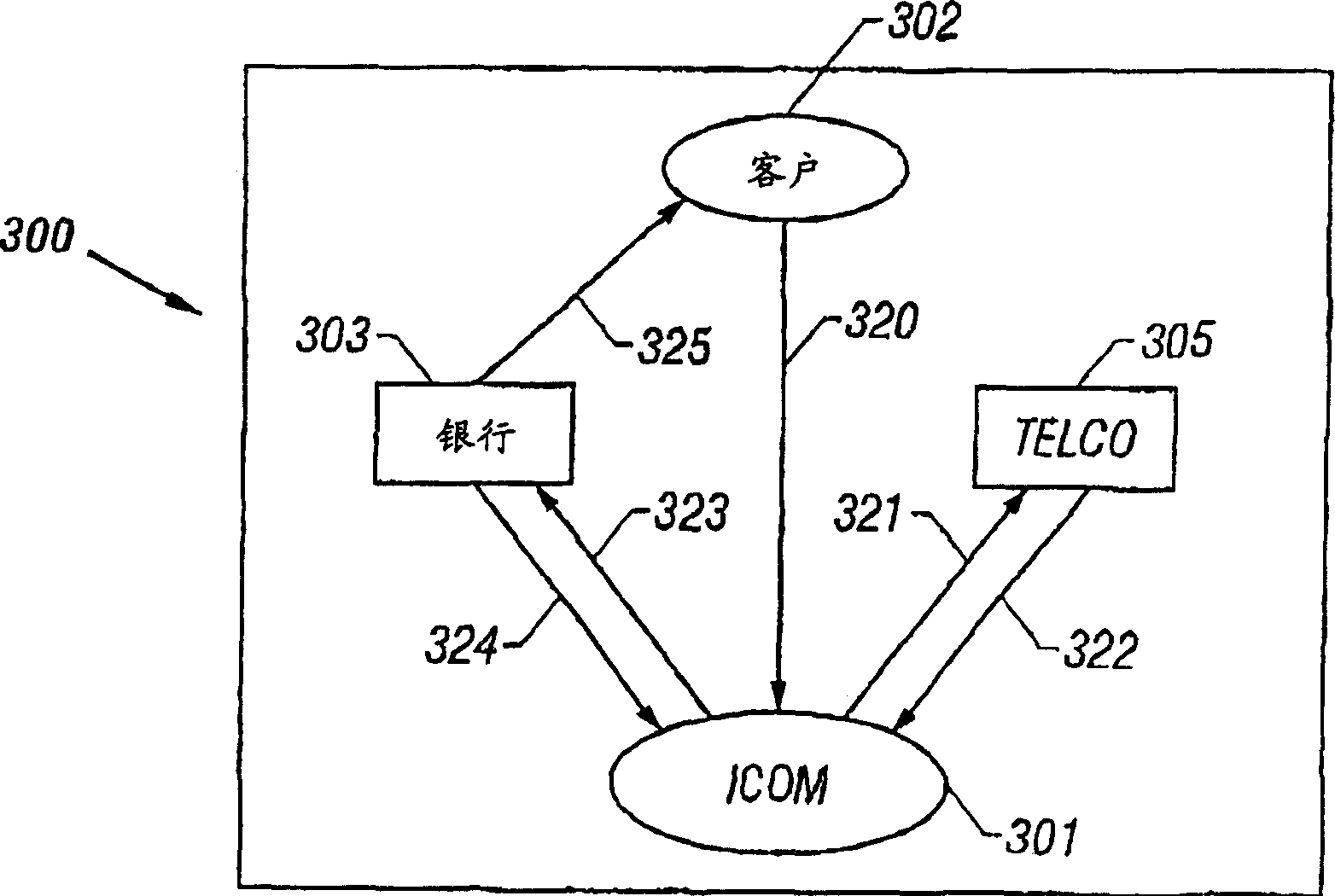

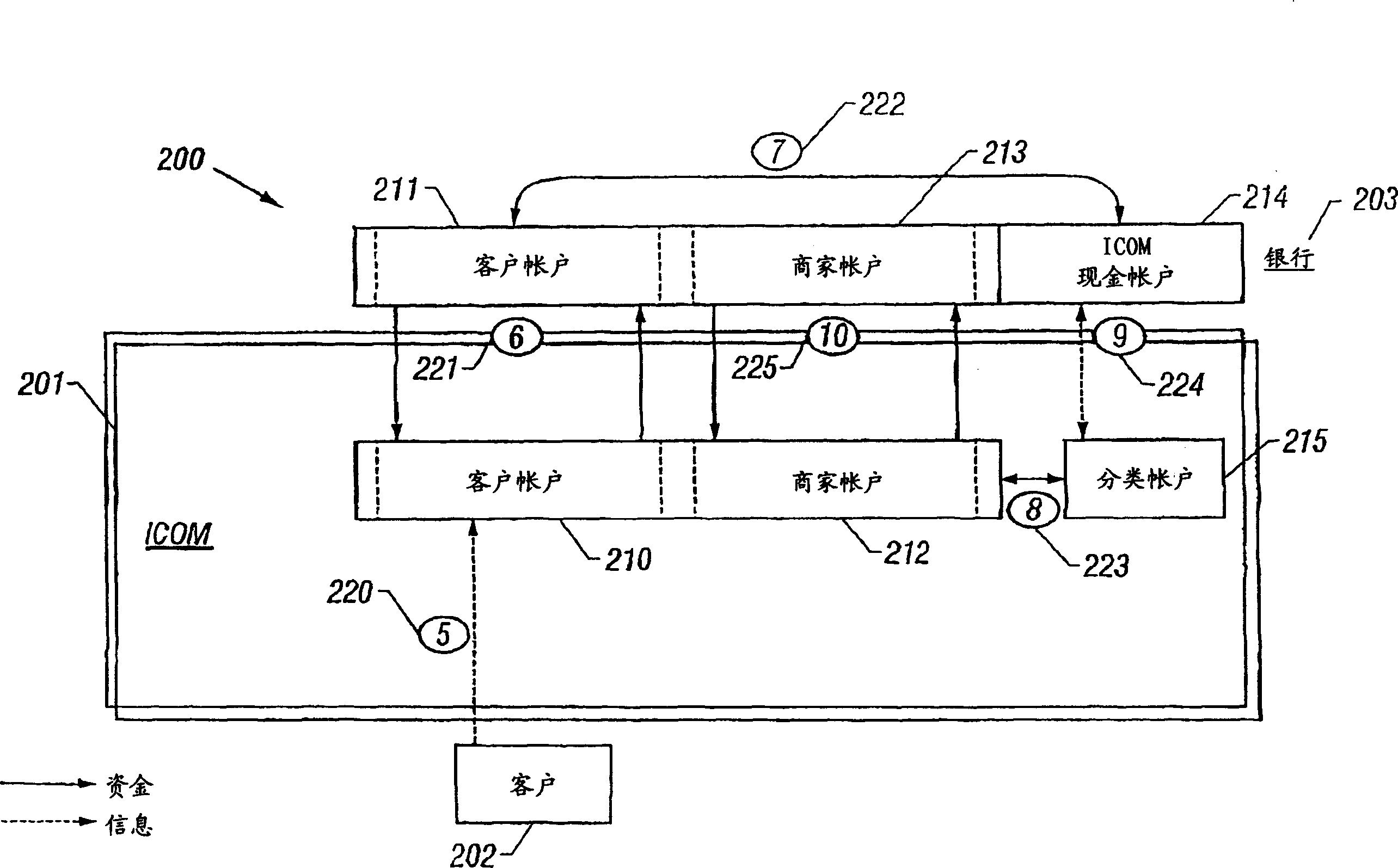

Remote payment method and system

InactiveCN1539122ACredit will not be lostComplete banking machinesPayment circuitsPayment transactionMerchant account

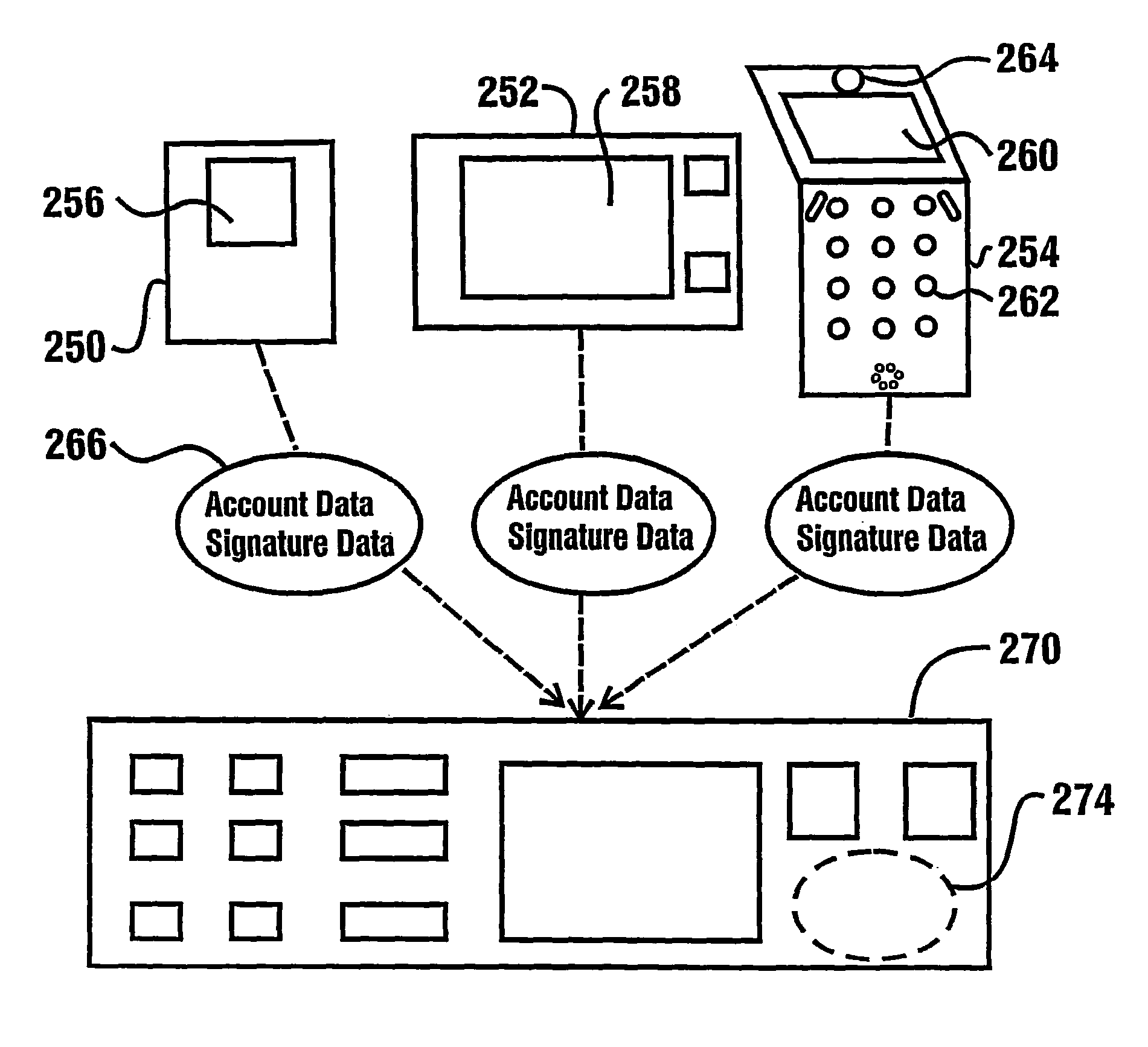

A computer-based method and system for effecting a remote payment transaction involving the use of a mobile communications device. Using the described system and the communications device, a customer (102) may electronically purchase goods or services from a merchant (104), remit payments, track loyalty bonuses and effect enhanced personal financial account management with less effort, increased convenience and user-authorized security features for account access and manipulation. Using a mobile communications device, the customer instructs (120) the remote payment system to provide funds to the merchant, where the funds are transferred (121) from a customer account to a merchant account, and the merchant notified (122). If desired, the system automatically manages the value of these accounts by interacting with external financial accounts, such as bank accounts. The system also monitors transaction frequency and average account value to calculate a bonus to reward the customer's loyalty.

Owner:ICOM MOBILE

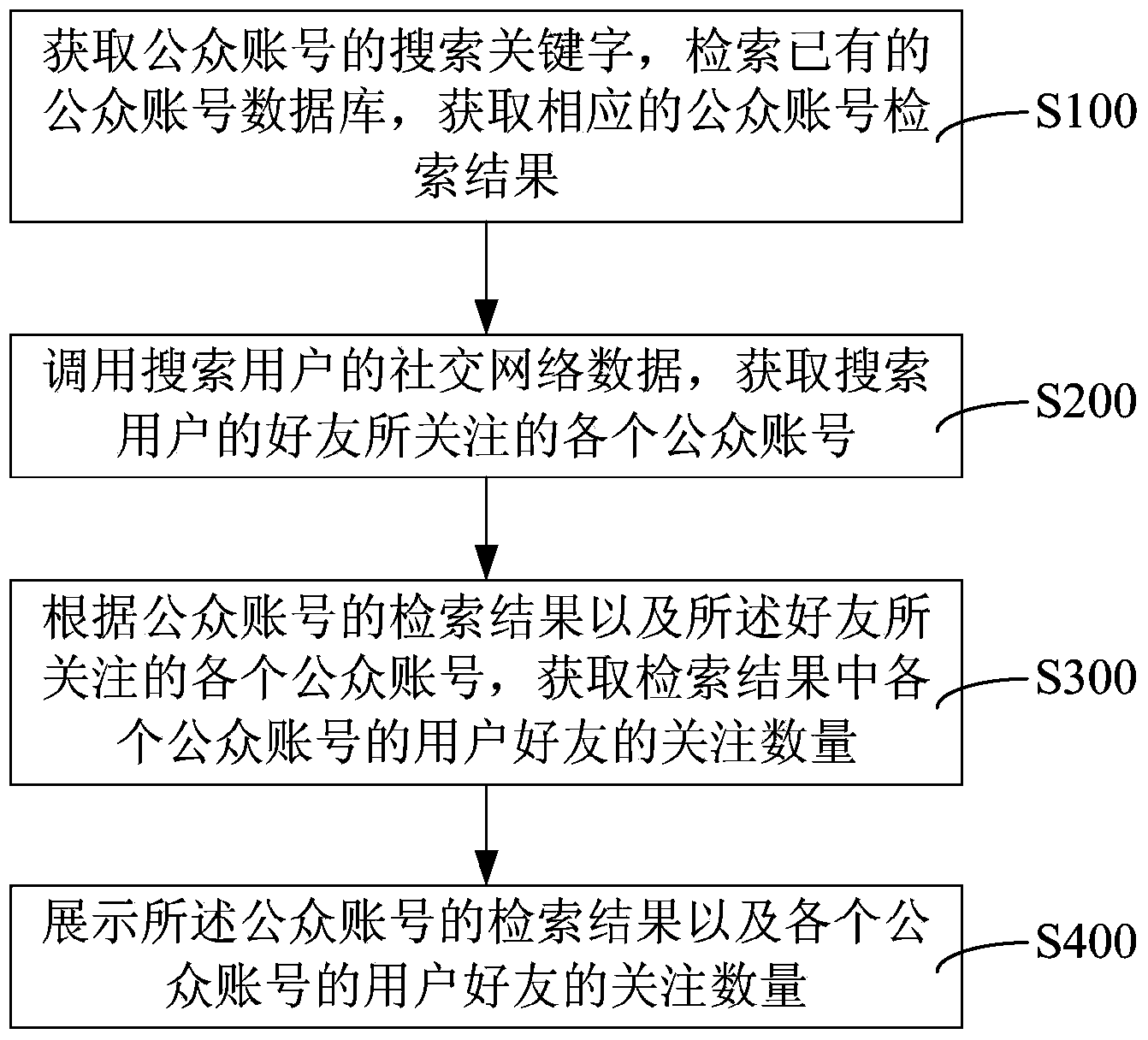

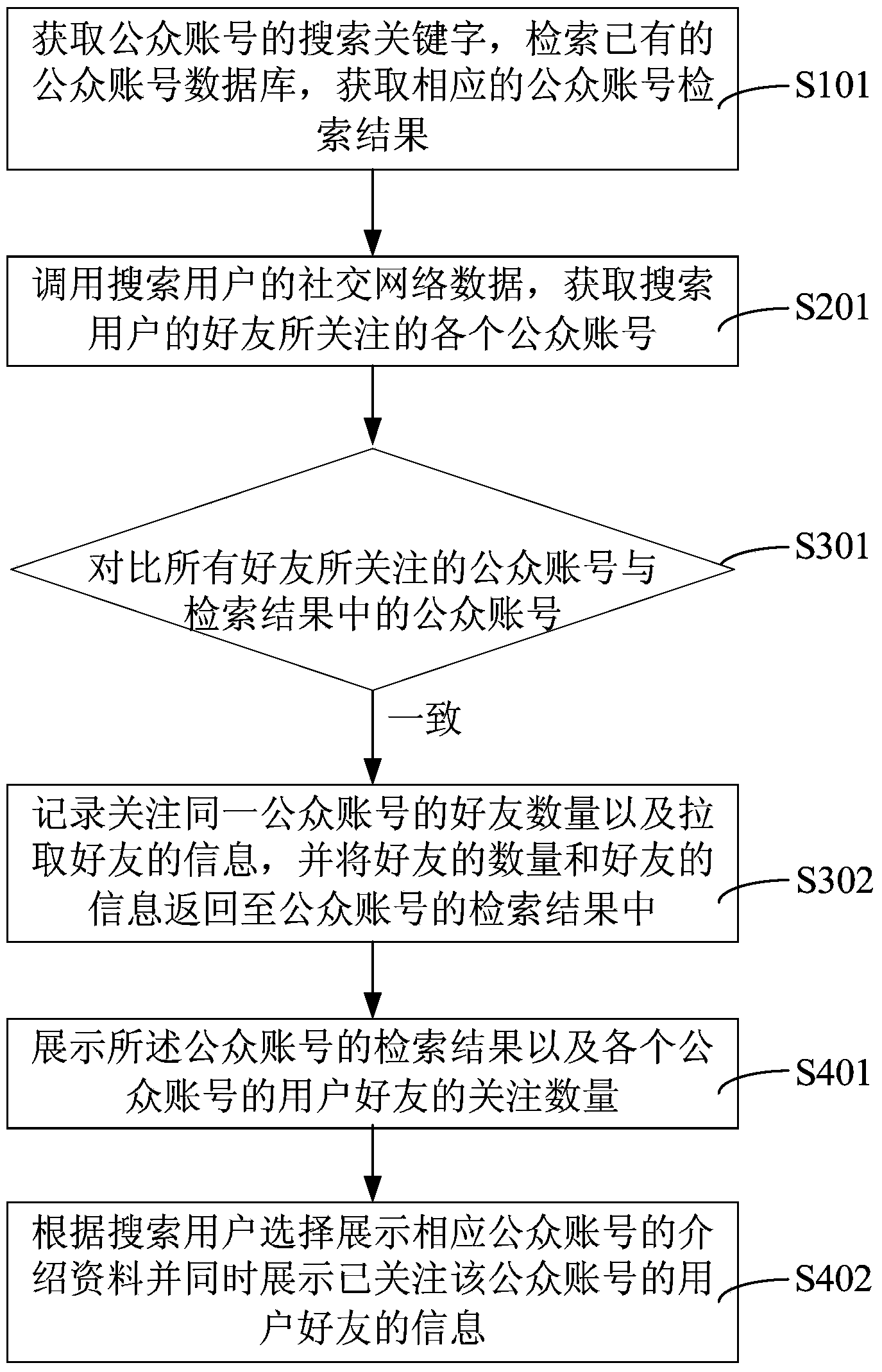

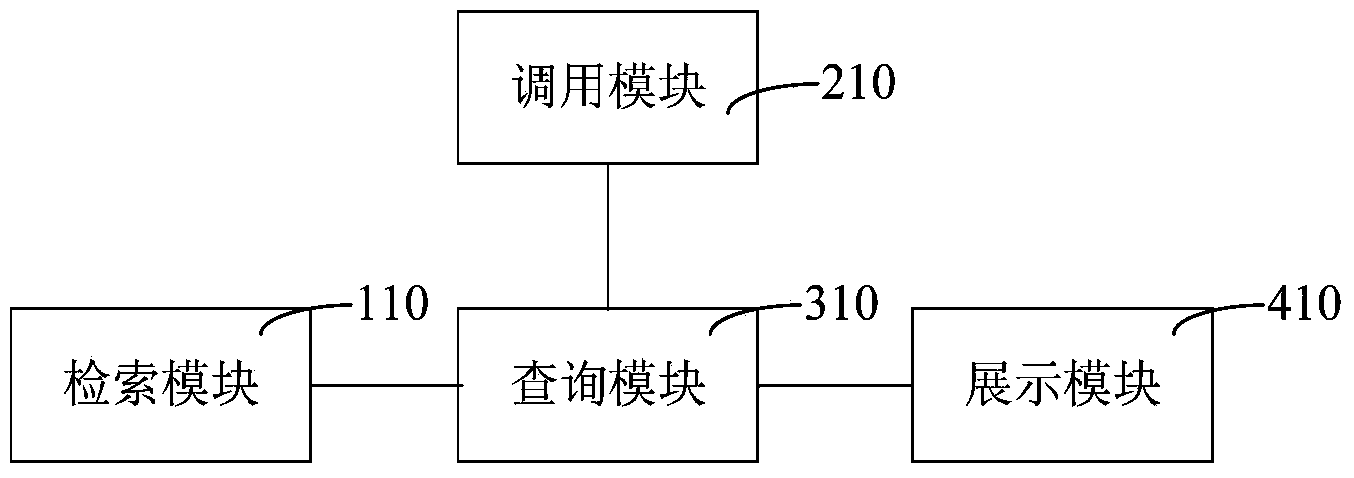

Method and system for searching social application public account numbers

ActiveCN104391846AReduce in quantityEasy to operateWeb data indexingMarketingPublic accountSocial web

The invention discloses a method and a system for searching social application public account numbers. The method comprises the steps of obtaining search keywords of the public account numbers, searching an existing public account database, and obtaining a corresponding public account searching result; calling social network data of a search user, and obtaining all public account numbers which are attended by friends of the search user; obtaining the attention number of user friends of all the public account numbers in the searching result according to the searching result of the public account numbers and all the public account numbers which are attended by the friends; showing the searching result of the public account numbers and the attention number of the user friends of all the public account numbers. According to the method and the system, disclosed by the invention, the influence of corresponding public account numbers in the own social network of the search user can be quickly and clearly known through the searching result by the search user, the number of checking the searching result by the search user is reduced, the operation steps and the operation times when an interested social application public account is selected by the search user are reduced, and the operation time of the search user is reduced.

Owner:深圳市雅阅科技有限公司

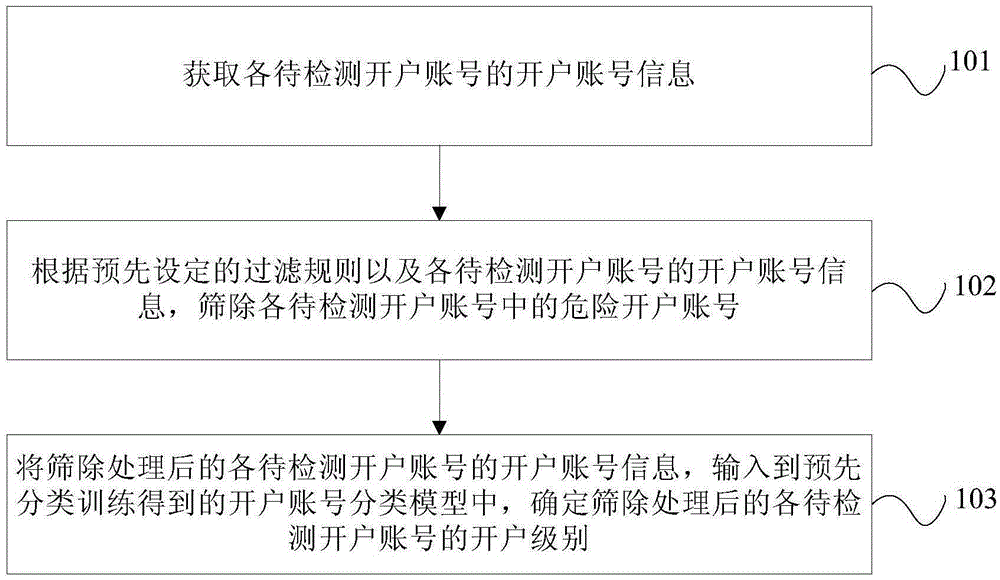

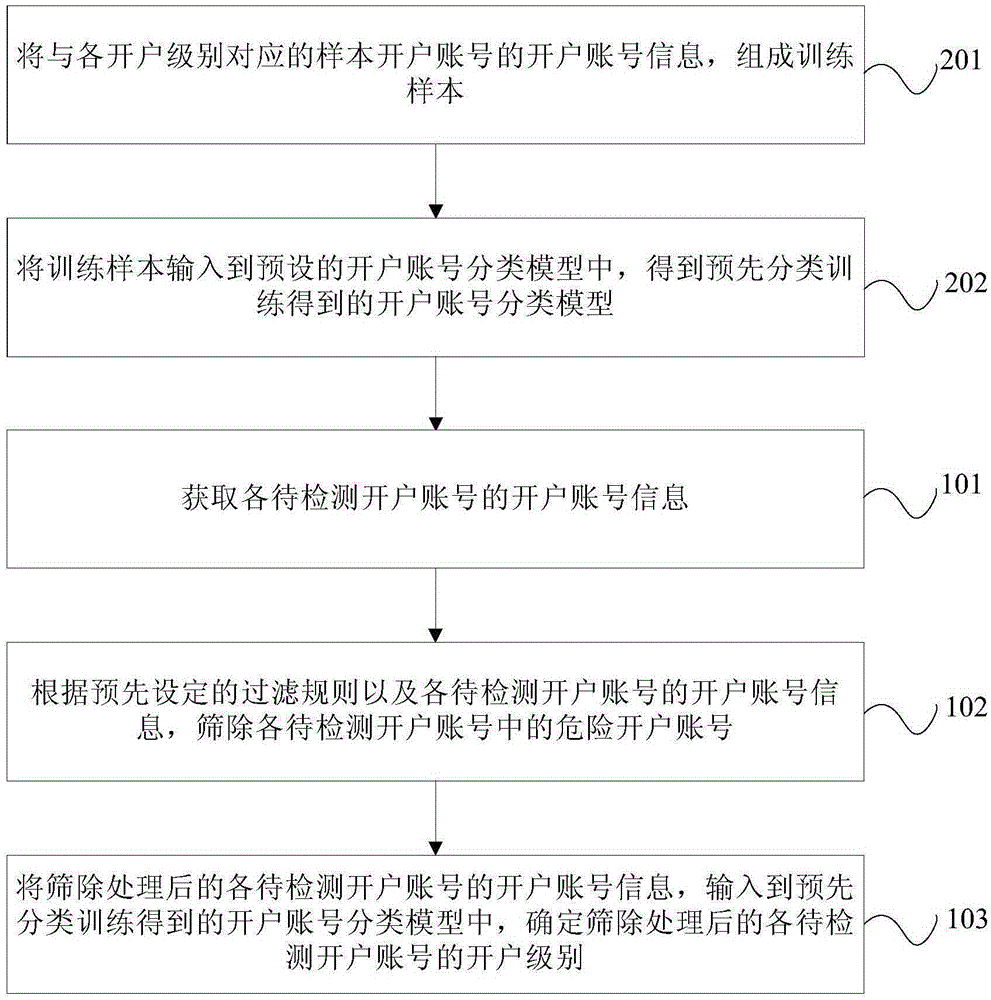

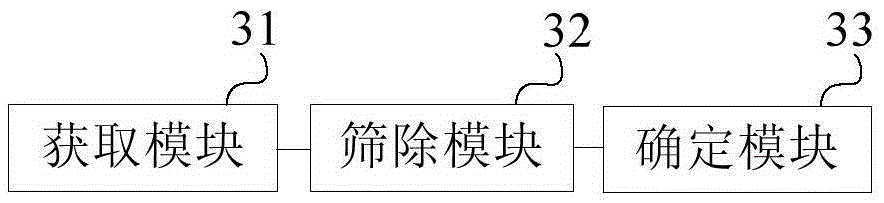

Online bank account number detection method and apparatus

InactiveCN105303442ADetect account opening levelImprove detection rateFinanceFiltering rulesData mining

The invention provides an online bank account number detection method and apparatus. The method comprises: obtaining account number information of to-be-detected account numbers; according to a preset filter rule and the account number information of the to-be-detected account numbers, filtering out dangerous account numbers in the to-be-detected account numbers; and inputting the account number information of the filtered to-be-detected account numbers into an account number classification model obtained by pre-classification training, and determining the account opening level of the filtered to-be-detected account numbers. Therefore, the account opening level of the account numbers is effectively detected, the detection rate of the account opening level of the account numbers is increased, and the account opening level of current online bank account numbers is accurately determined.

Owner:MINSHENG BANKING CORP

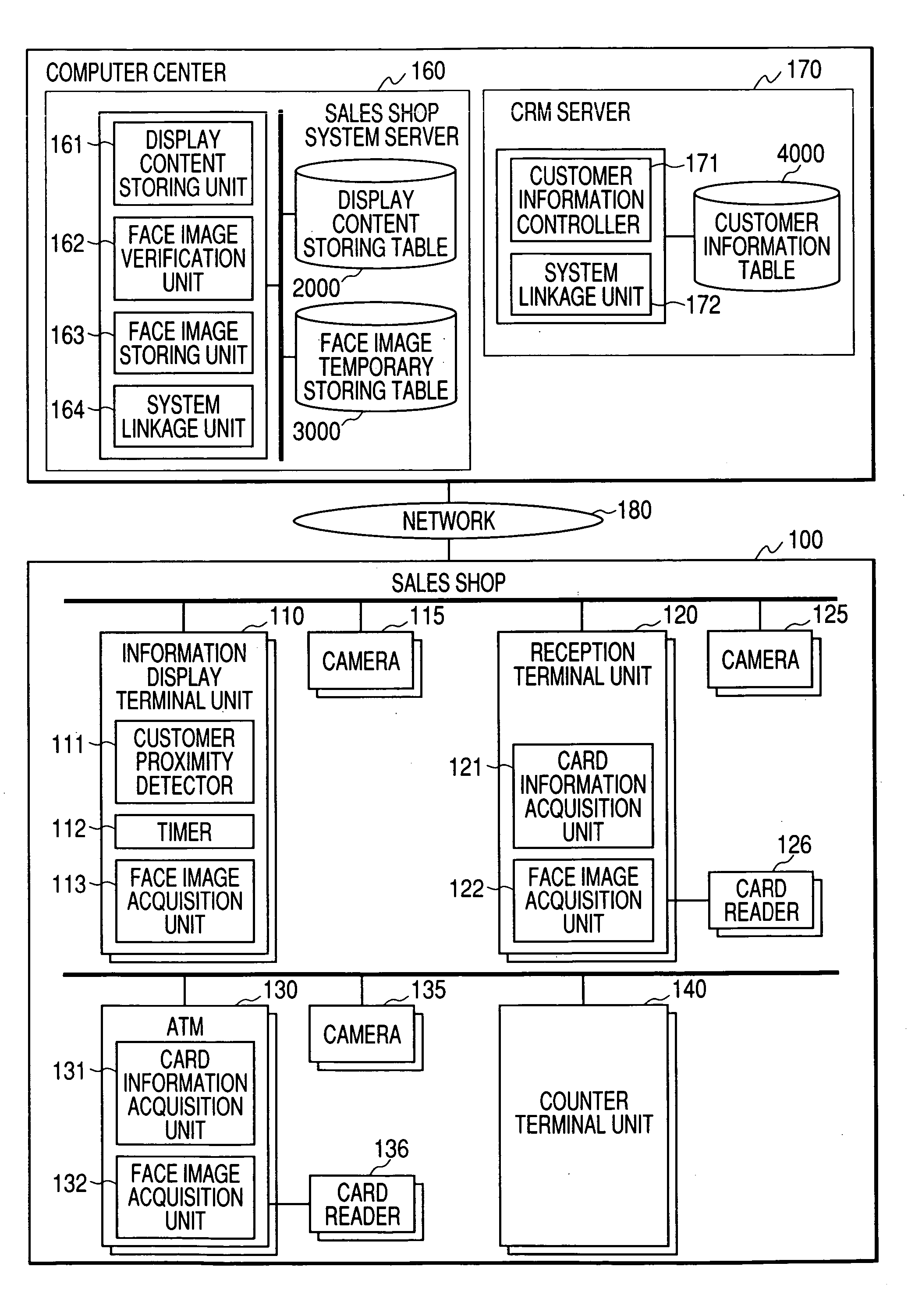

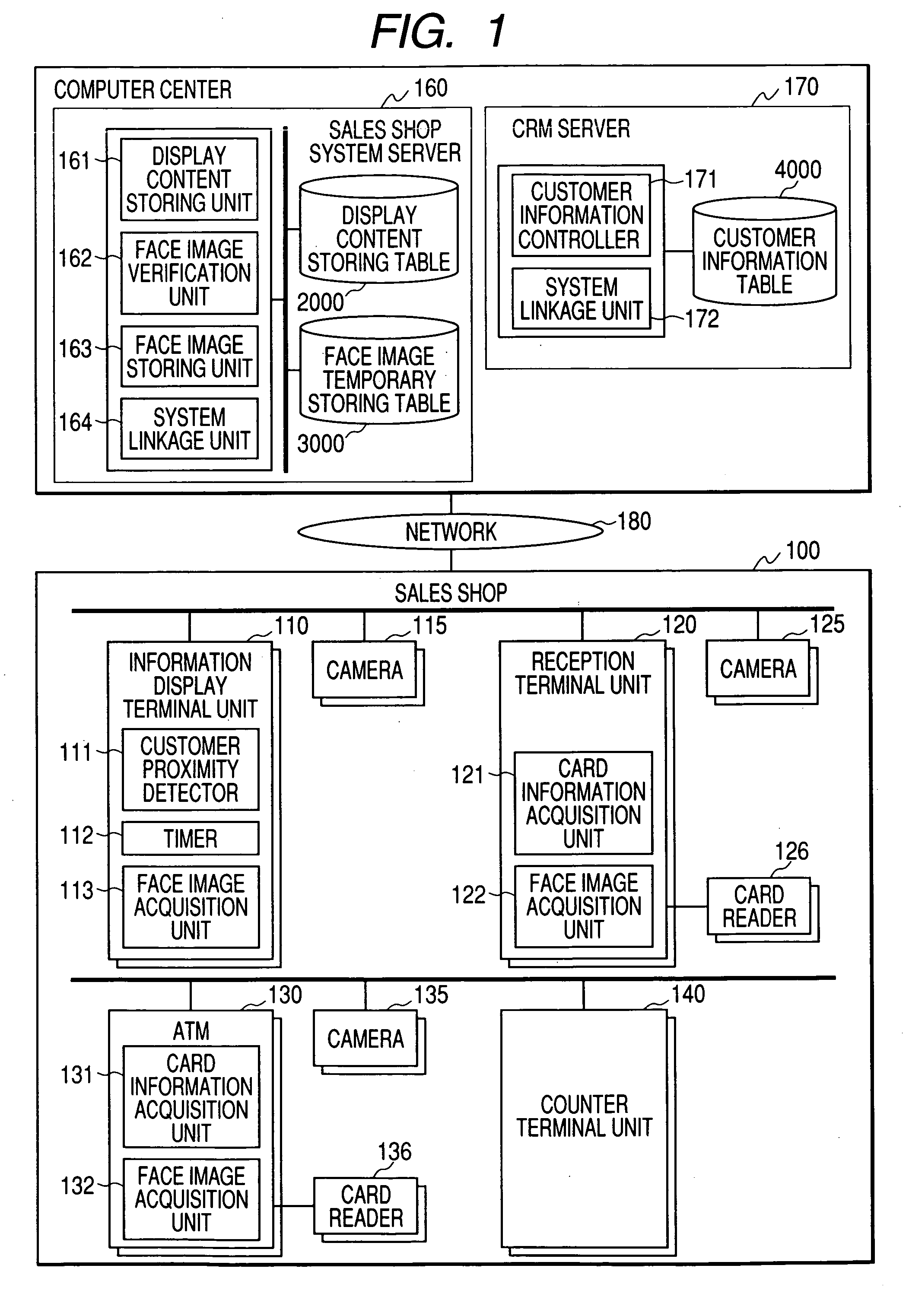

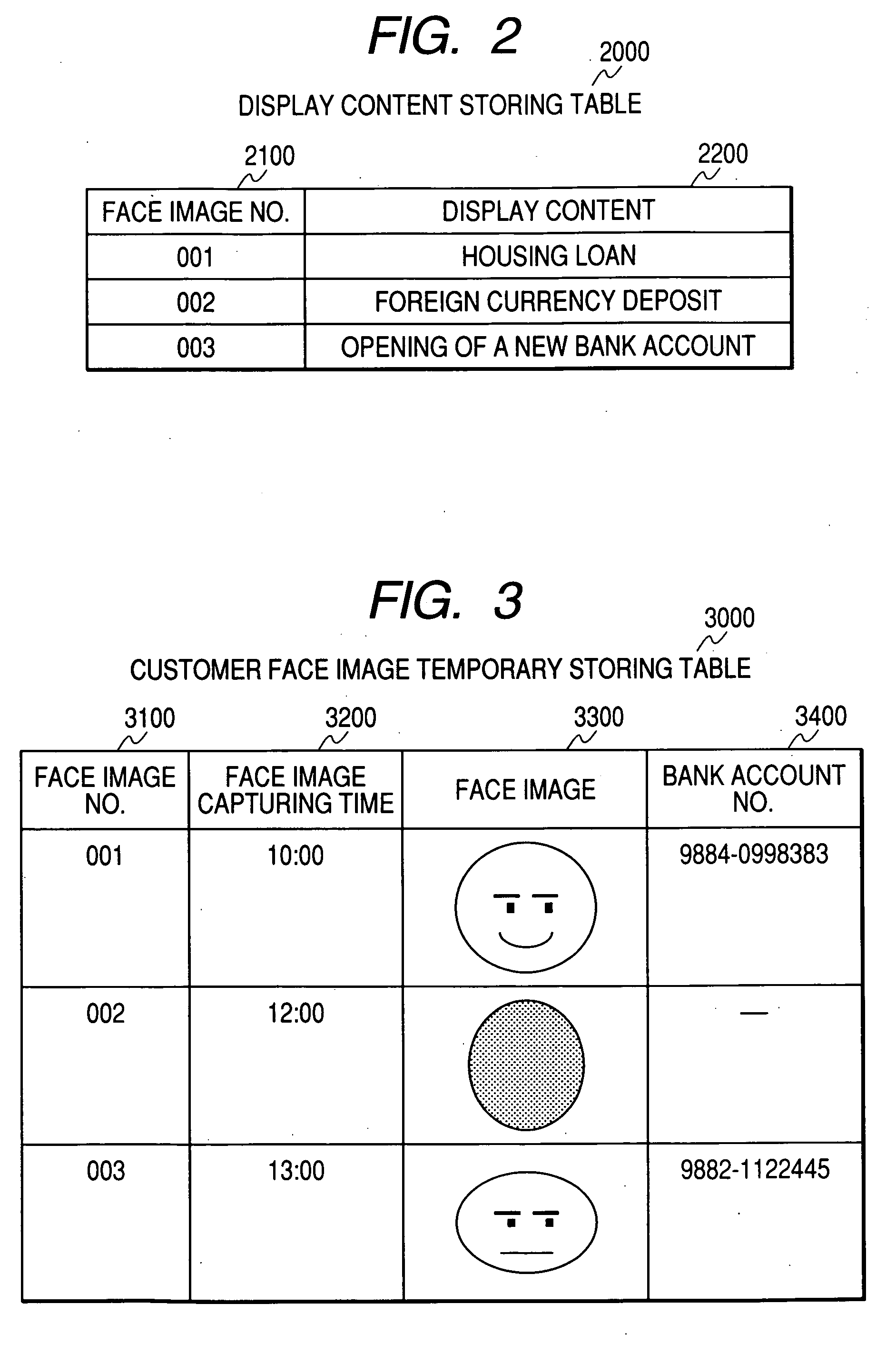

Sales shop system

Conventionally, to acquire specific information of a customer, acquisition of the information is only possible by using information such as a bank account number owned by the customer, and further it is not possible to present information beneficial to the customer unless information owned by the customer is acquired from the customer. More specifically, there is a problem in that much time is necessary for a customer or a system operator to input such information. To solve the above-stated problem, the present invention outputs information associated with a customer by using biometric information including a face image. More specifically, biometric information is acquired from a user of a first terminal unit included in a plurality of terminal units, and information associated with an operation made by the user is identified. Then, when the user is going to use a second terminal unit (or when the second terminal unit executes processing of information on the user based on inputs by a third party, etc.), biometric information is acquired from the user, and information that is identified by an operation made on the first terminal unit is retrieved for output by using the biometric information.

Owner:HITACHI LTD

Information collection, transmission, processing system and method based on mobile phone short message

InactiveCN1794298ATrade anytimeReduce data volumeFinanceRadio/inductive link selection arrangementsHandling systemComputer science

This invention relates to a system and a method for information collection, transmission and process based on the short message of a cell phone to constitute a unified standard electronic trade system based on short messages of cell phones. Since this invented system and method transmits the bank account numbers and codes in the system by different routes and they cannot be interrupted on a same route at the same time, the bank account information of the user can be guaranteed safely.

Owner:BEIJING YIFUJINCHUAN TECH

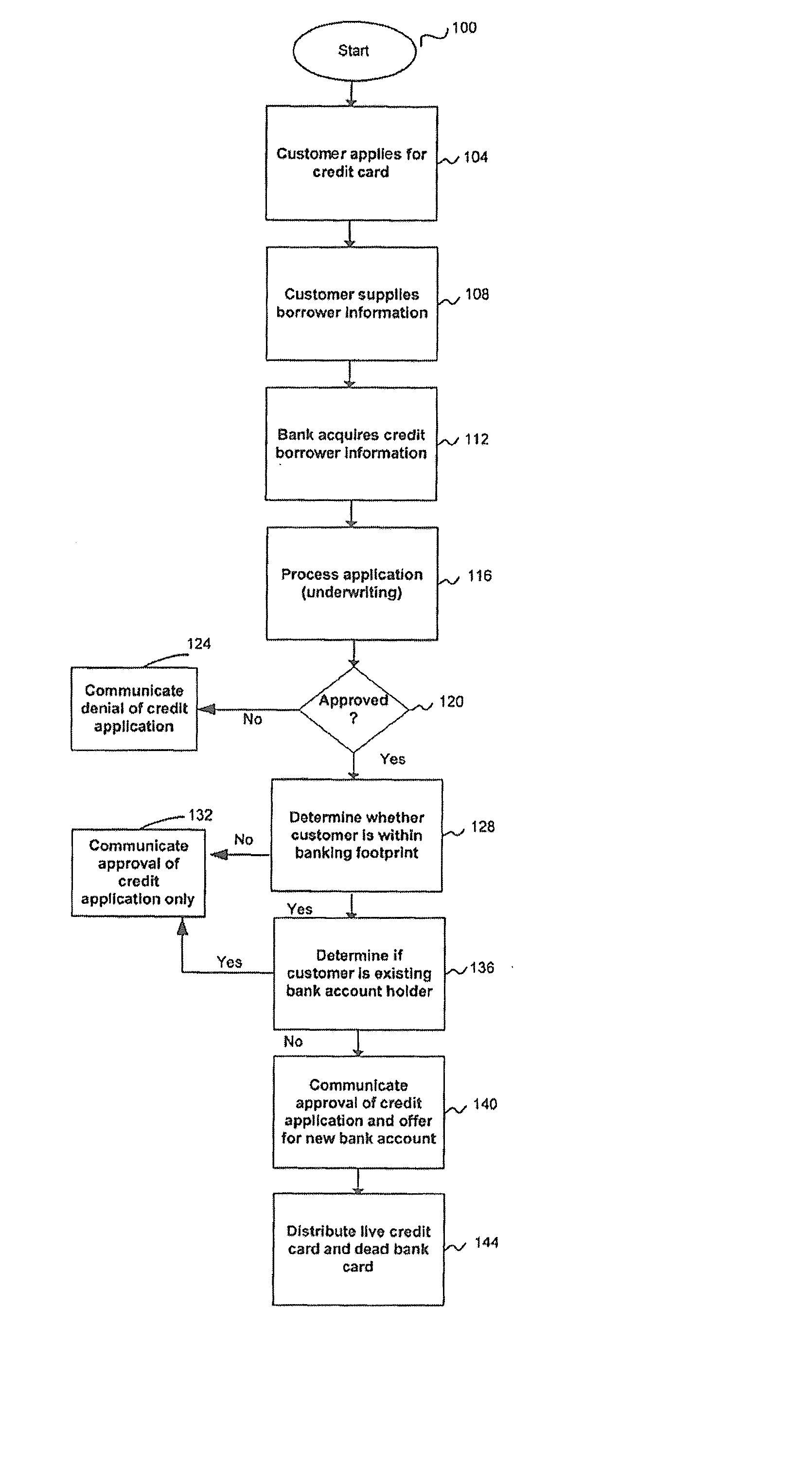

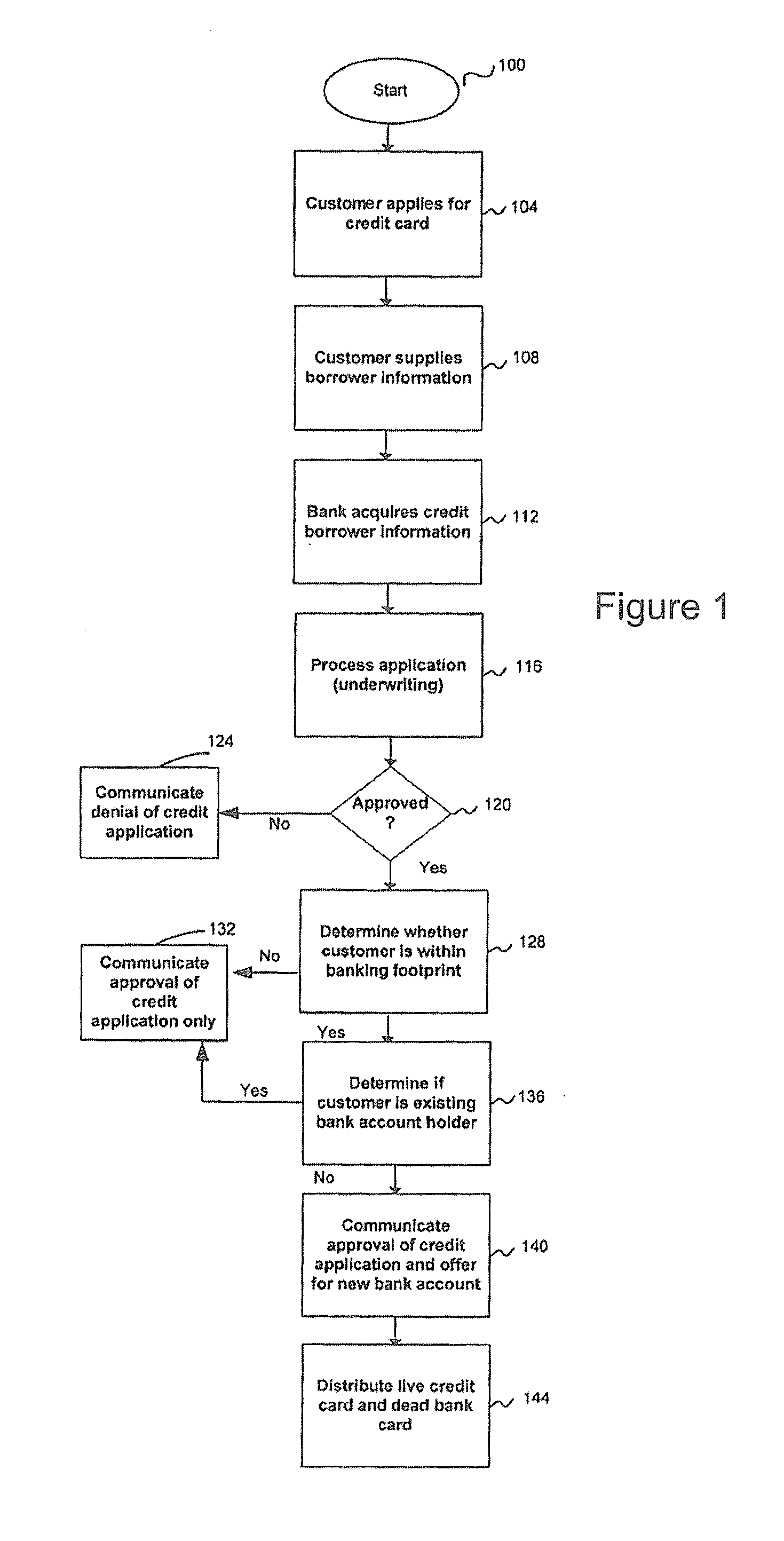

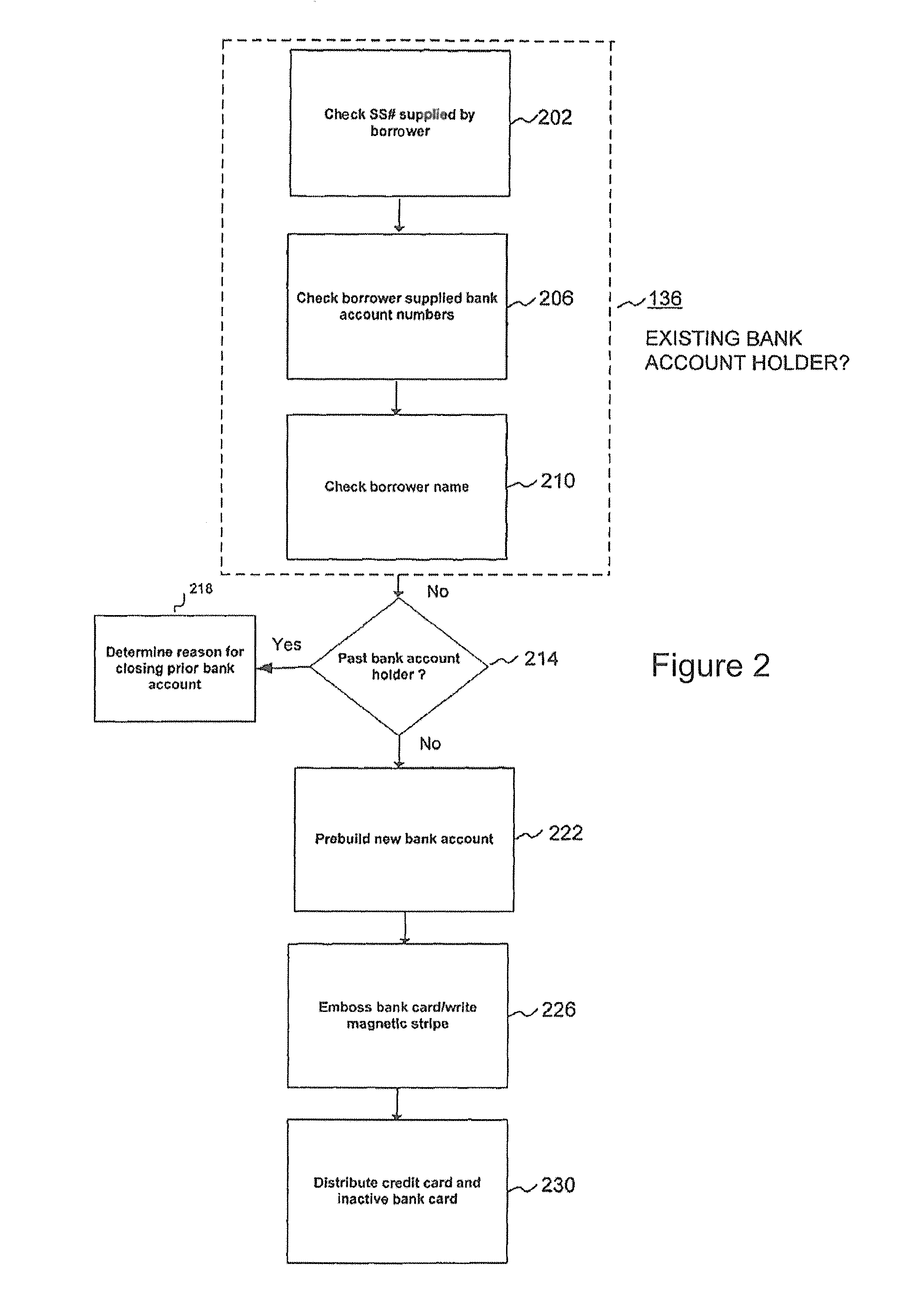

Method and System for Distribution of Unactivated Bank Account Cards

ActiveUS20070299756A1Immediate activationFinancePayment architectureComputer hardwareBiological activation

The invention comprises a method for distributing dead bank cards to customers who have not solicited a bank card or submitted an application. The dead bank card is a bank card (e.g., ATM card, debit card, check card, and the like) which contains all necessary information to be used, including a pre-assigned bank account number, and which only requires activation / approval by the prospective new bank account customer. In one embodiment, the dead bank card is distributed in connection with live credit cards issued to applicants for credit card accounts. Once operative, the bank card and the credit card may be linked together through a rebate / rewards program.

Owner:CHASE MANHATTAN BANK USA NAT ASSOC

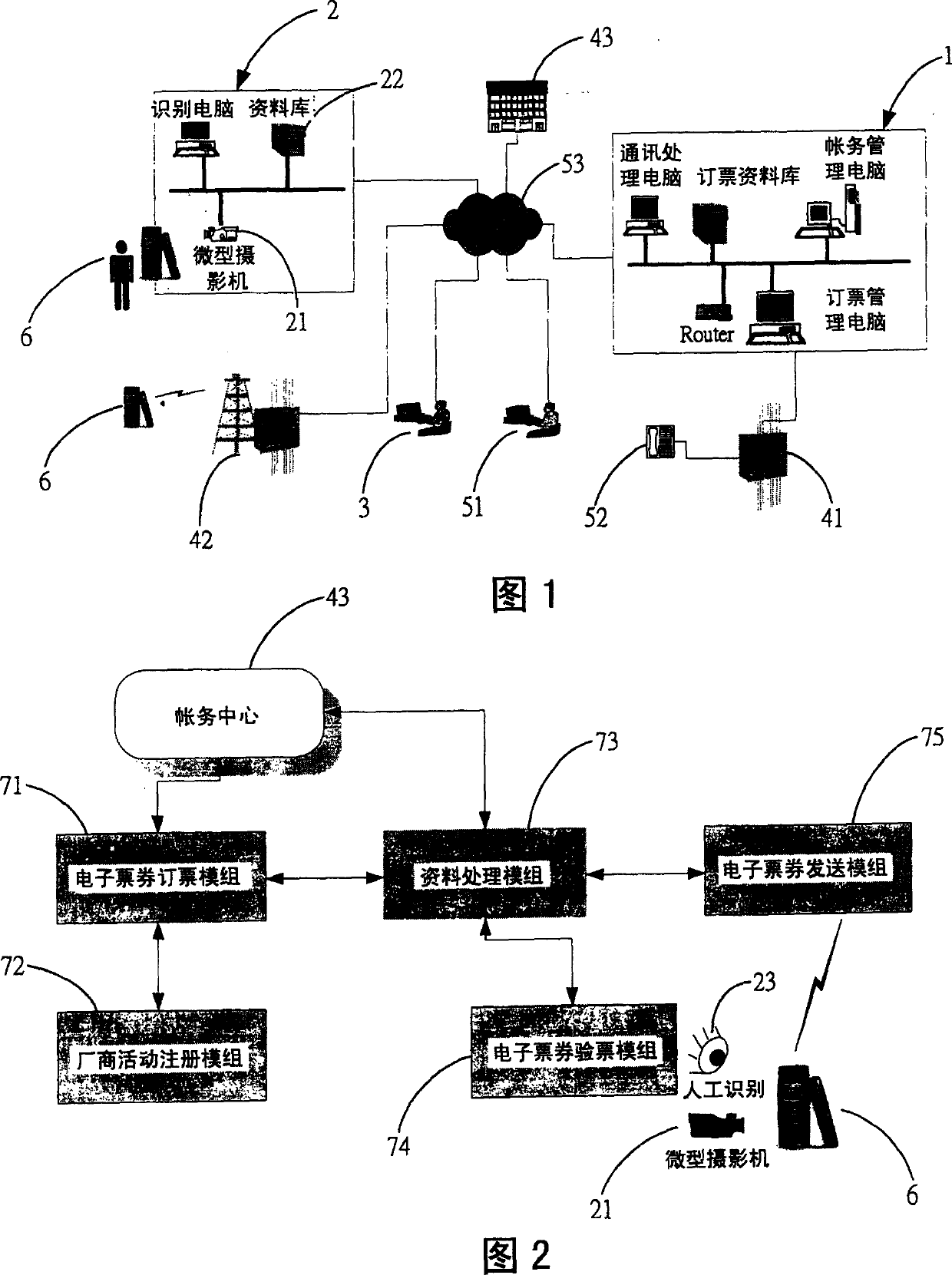

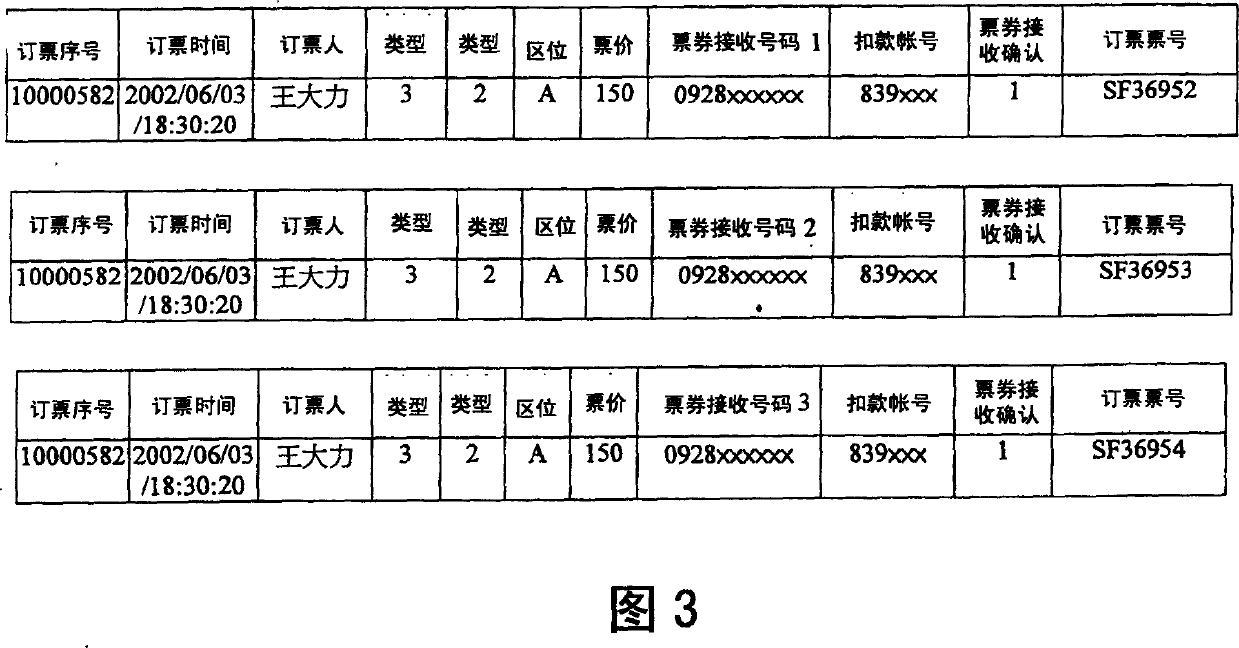

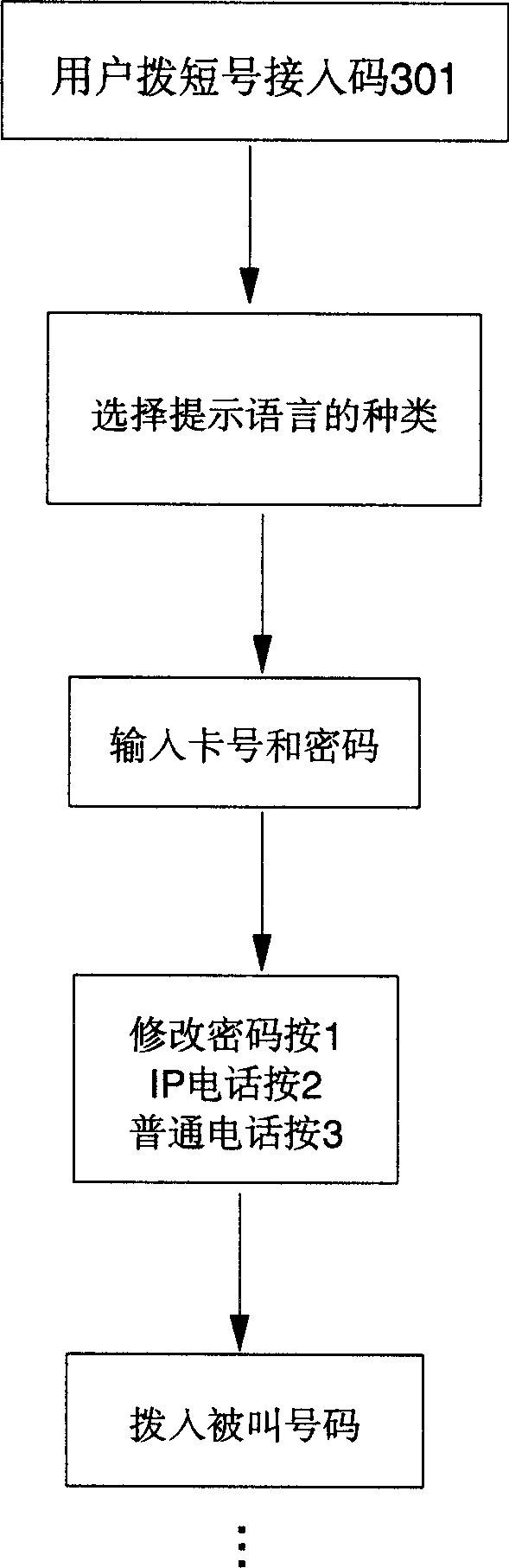

Finance bills management system using electronic finance bills as charging certification basis

InactiveCN1542664ARadio/inductive link selection arrangementsTransmissionRadio networksComputer science

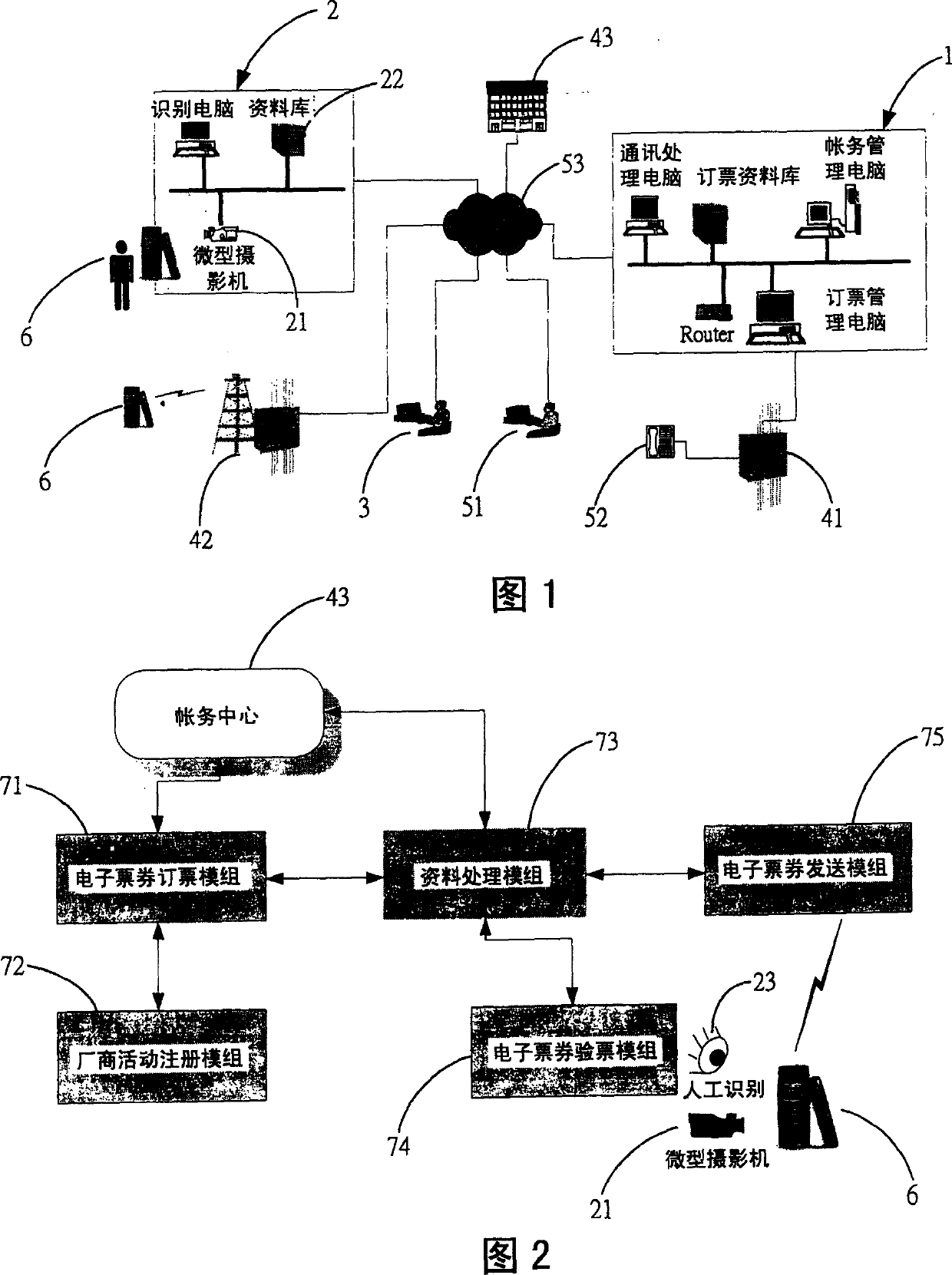

The present invention is one kind electronic ticket management system. During booking ticket, the ticket booking person books via voice booking private line, radio network or Internet and transmits the booking content together with bank account number and cipher to the ticket holde based on the information of electronic ticket business center, and after passing through the check, the ticket booking is completed. After that, the electronic ticket business center transmits the electronic ticket to the mobile phone or PDA of the ticket holder via the short message center or WAP service center, the ticket holder receives and confirms the electronic ticket, and the short message center or WAP service center replies the electronic ticket business center to complete the ticket taking process.

Owner:CHUNGHWA TELECOM CO LTD

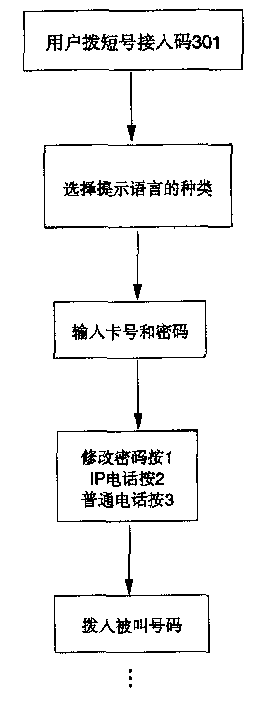

Method for realizing after payment business

InactiveCN1438787AEasy to usePowerfulMetering/charging/biilling arrangementsLocal callOperating system

The method for realizing the service of after payment includes the following steps. Customers having fixed telephones apply to a telecom operation company for the service of after payment. Then, the telecom operation company allocates fixed card number for the service of after payment and the ciphering code to the applicant. The applicant is allowed to make local call and remote roam through the specific service access number. The operational management station of the telecom operation company charges the calling fees generated as well as counts and records the fees on the card number for the service of after payment. The said fees are paid with deduction automatically by the month from the bank account of the card number.

Owner:HUAWEI TECH CO LTD

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com