Patents

Literature

93 results about "Passbook" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

A passbook or bankbook is a paper book used to record bank, or building society transactions on a deposit account. Traditionally, a passbook is used for accounts with a low transaction volume, such as a savings account. A bank teller or postmaster would write by hand, the date and amount of the transaction and the updated balance and enter his or her initials. In the late 20th century, small dot matrix or inkjet printers were introduced capable of updating the passbook at the account holder's convenience, either at an automated teller machine or a passbook printer, either in a self-serve mode, by post, or in a branch.

Electronic bankbook, and processing system for financial transaction information using electronic bankbook

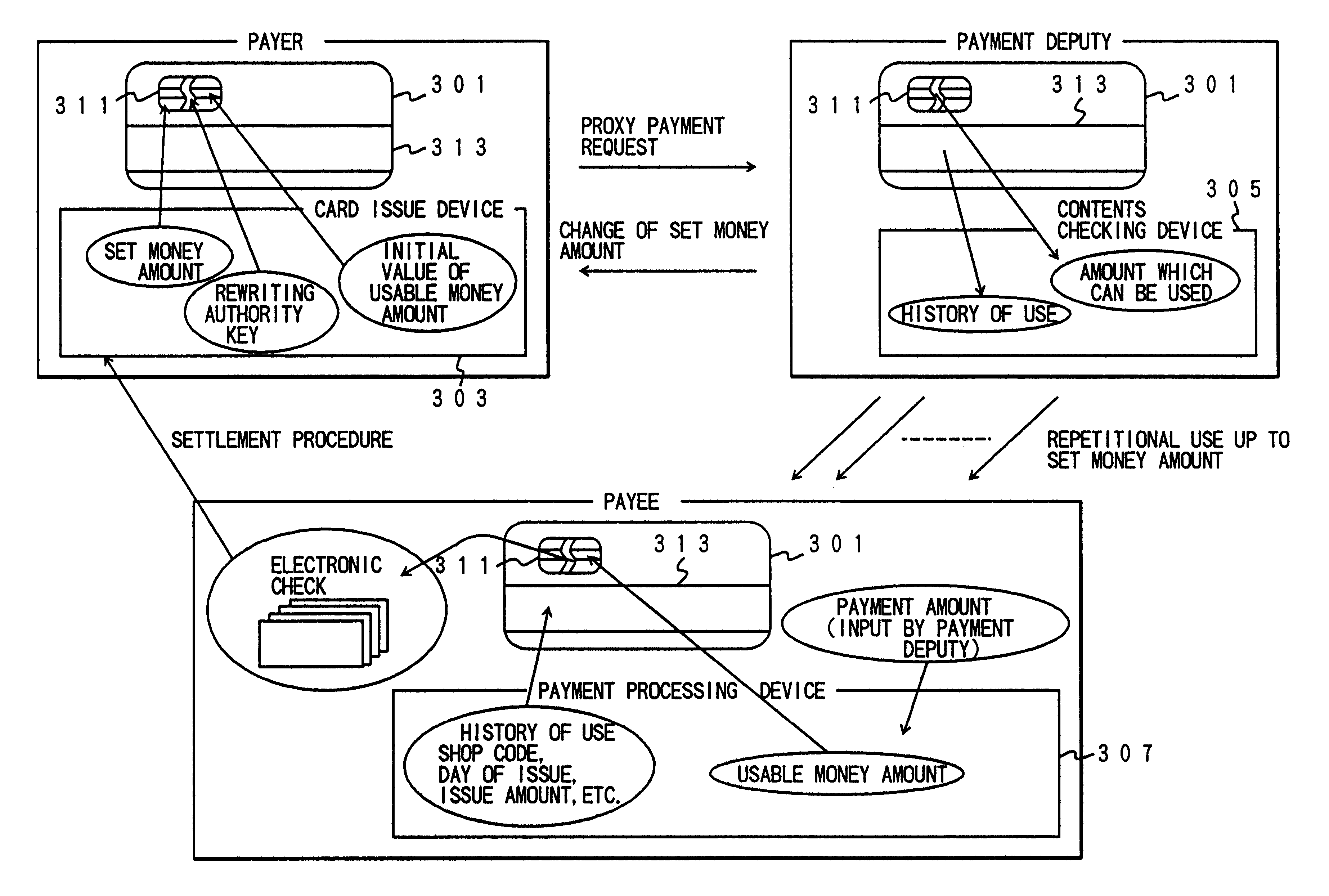

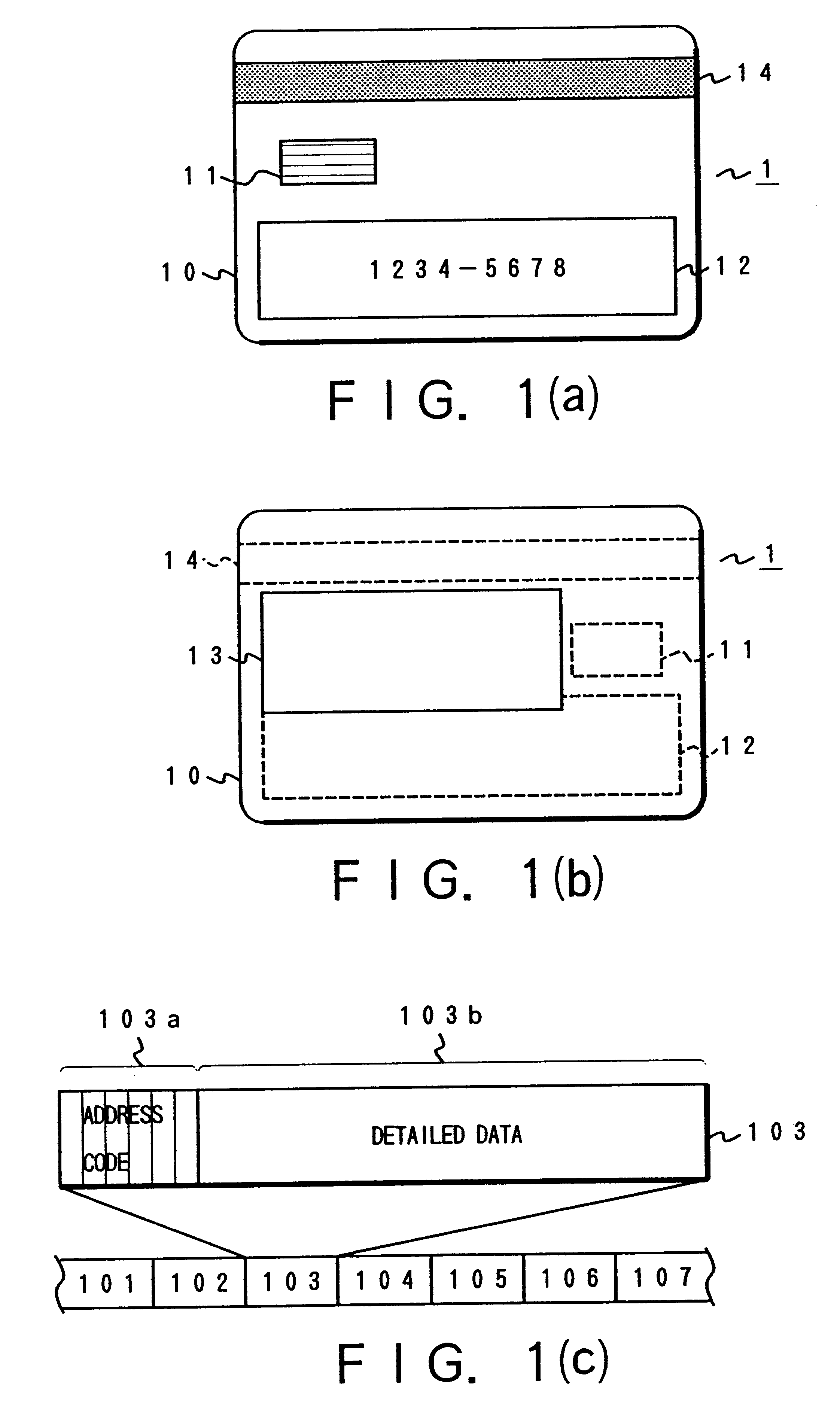

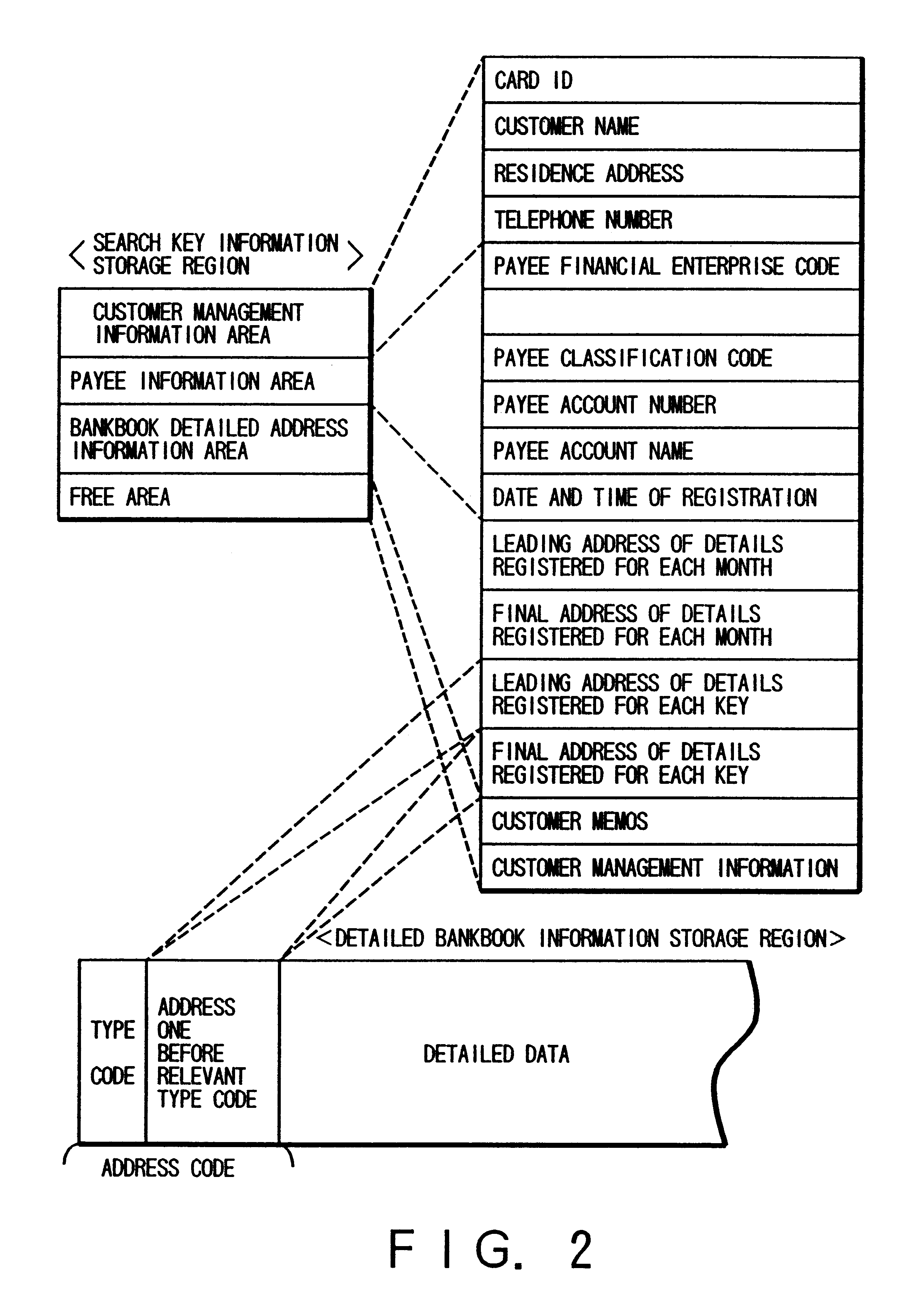

The object of the present invention is to propose an account bankbook, a money transfer card, a receipt file, and a checkbook utilizing an optical card, an IC card, or a hybrid optical / IC card. On the surface of a resin card base board 1 are formed an IC chip 11, an optical recording sheet 13, a magnetic stripe 14, and an embossment 12. In a semiconductor memory within the IC chip 11 are written validation keys, search keys, payee information, the upper limit amount of a check, and a program for processing transaction data. Access restrictions corresponding to various applications are imposed upon these data. The history of various cash transactions is recorded in the optical recording sheet 13. These records are of write-once type and rewriting or deletion thereof is impossible.

Owner:N T T DATA TSUSHIN KK

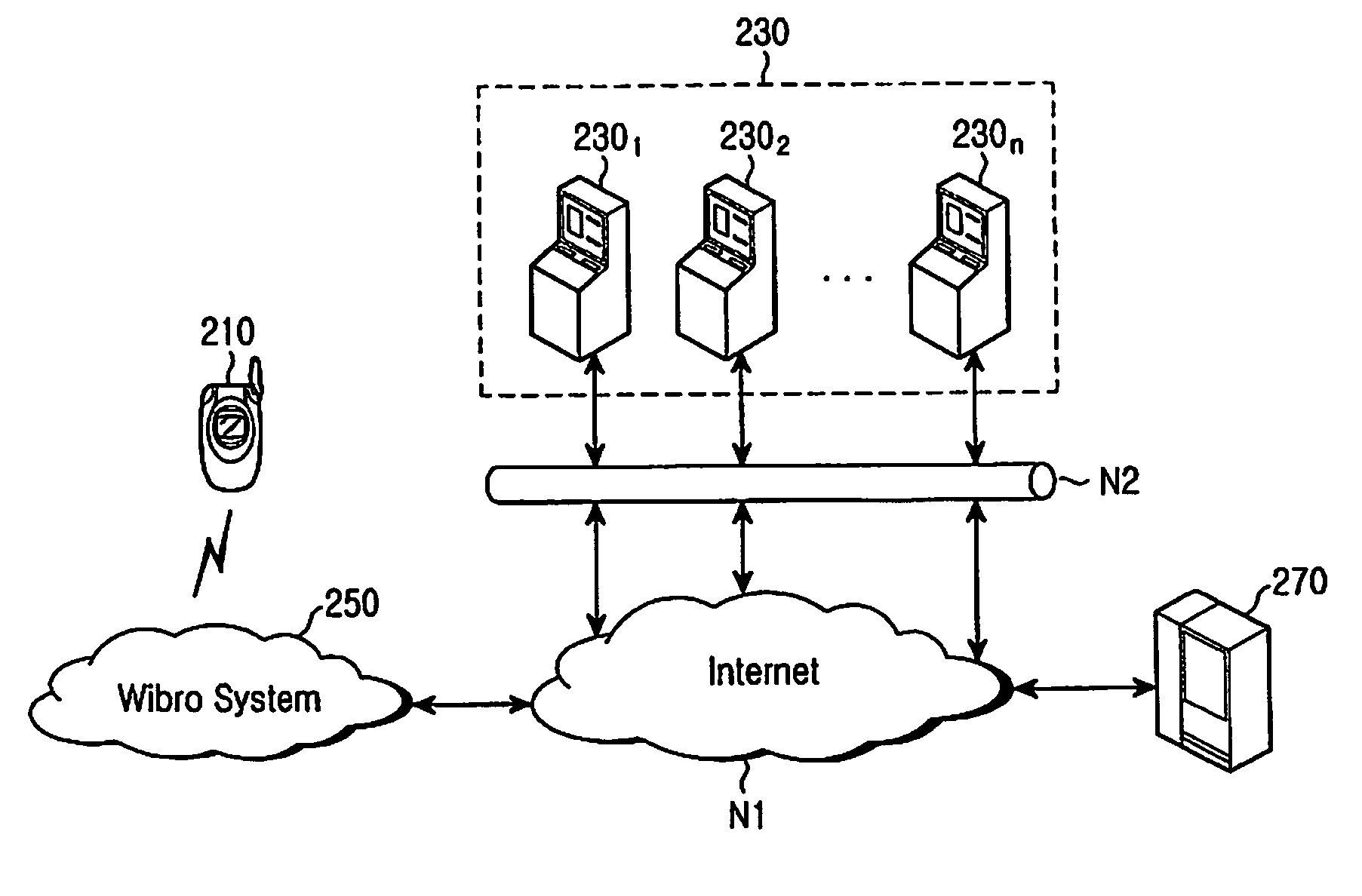

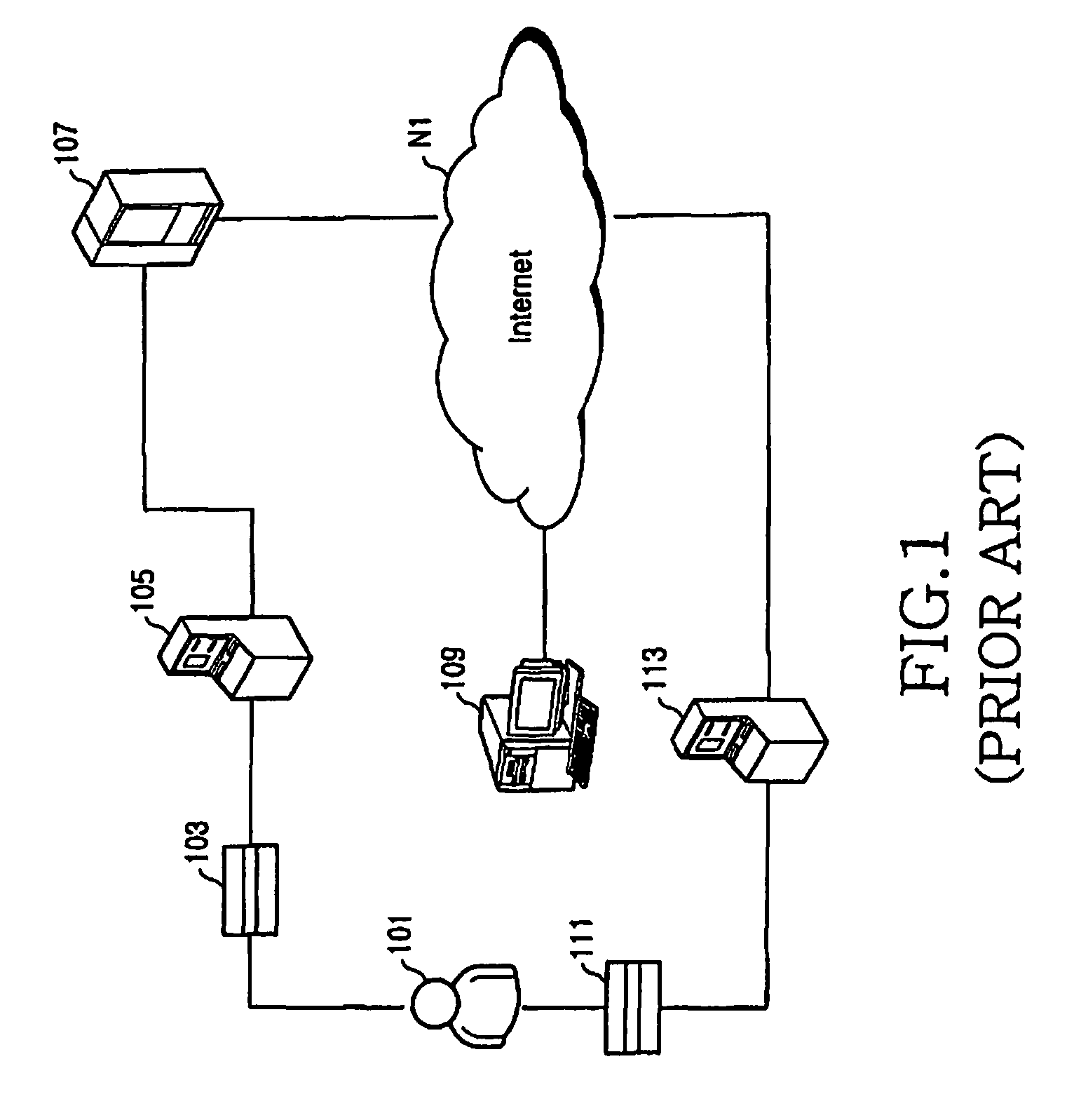

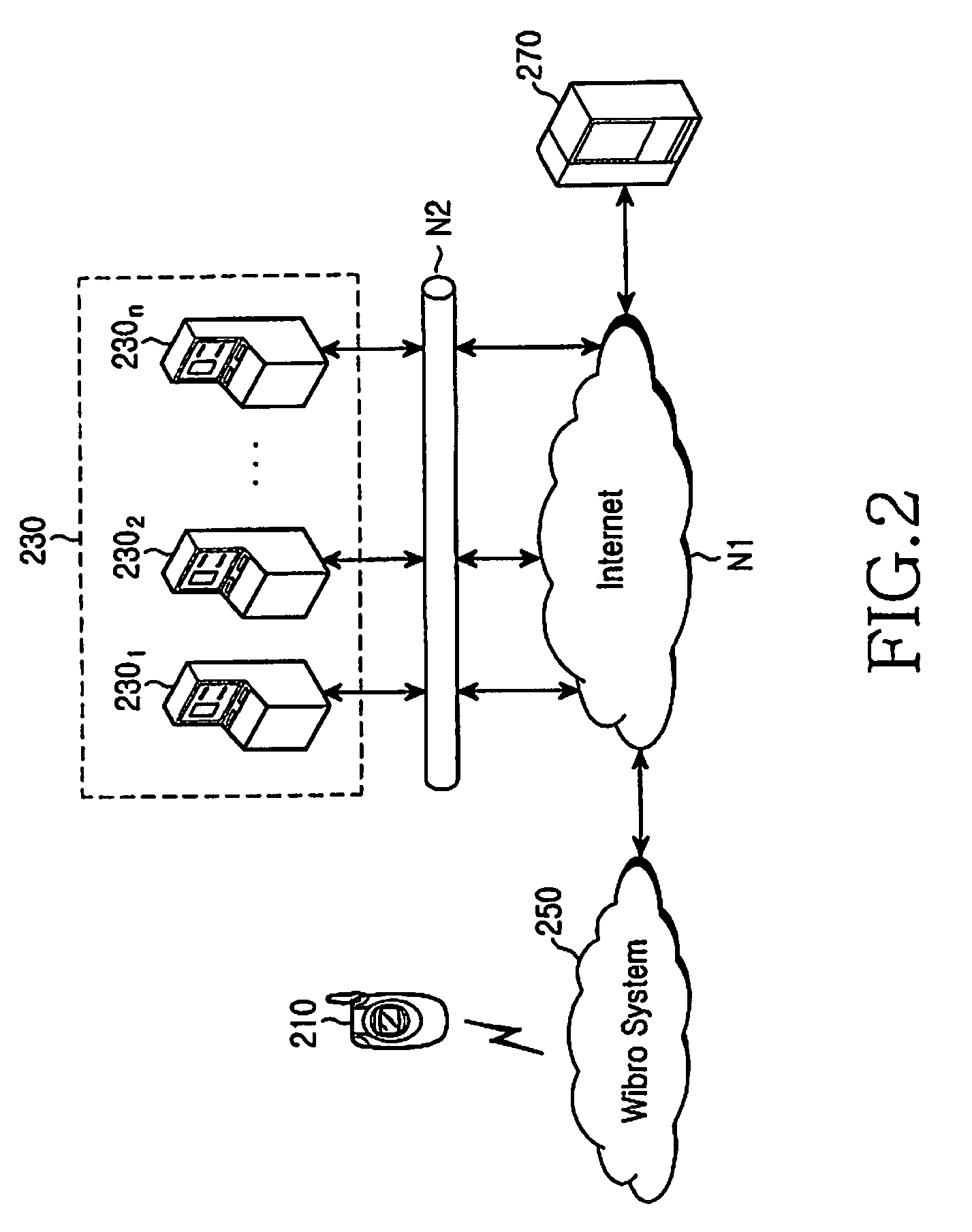

Method, apparatus and system for providing financial service by using mobile station in packet data system

Owner:SAMSUNG ELECTRONICS CO LTD

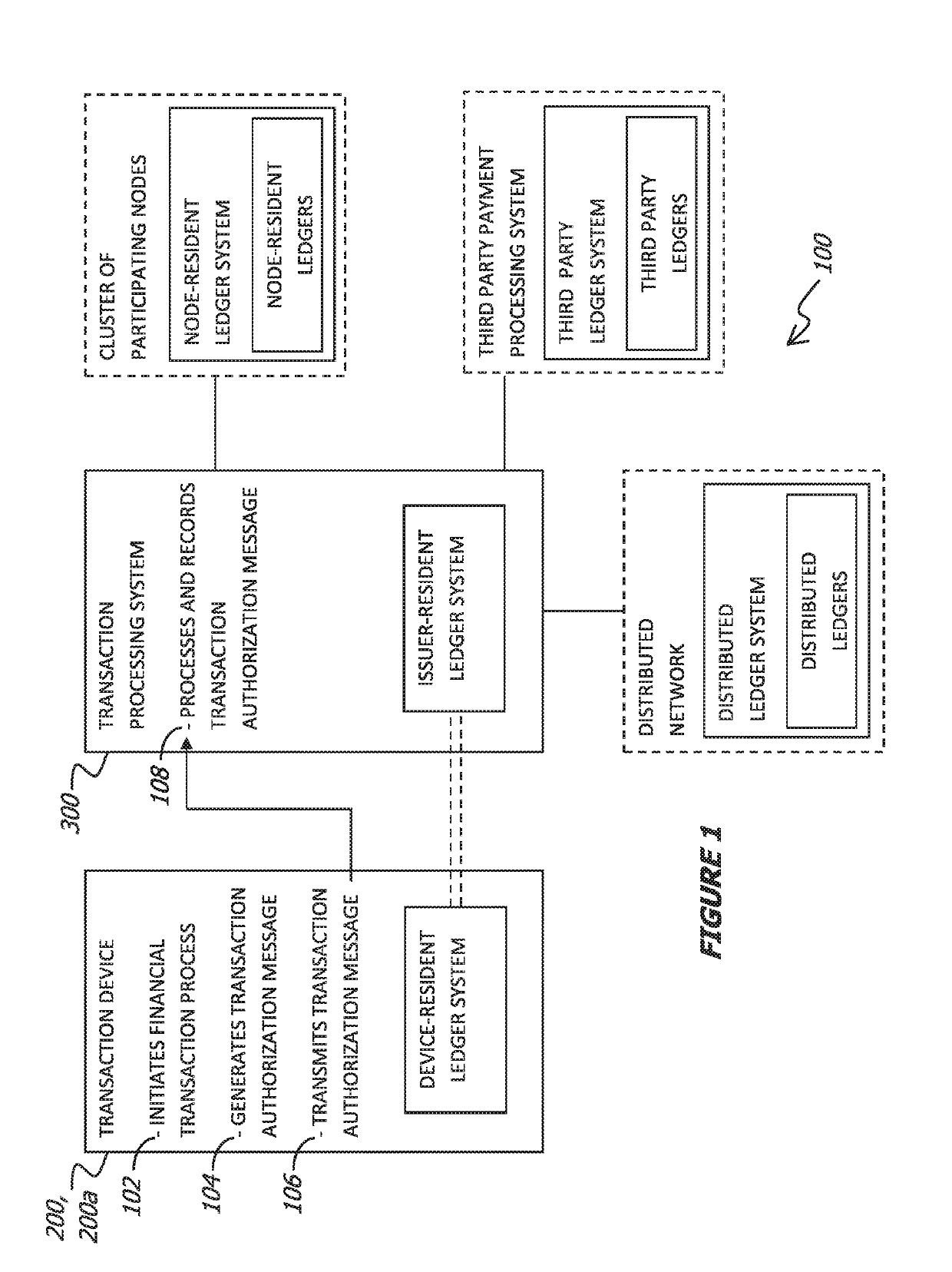

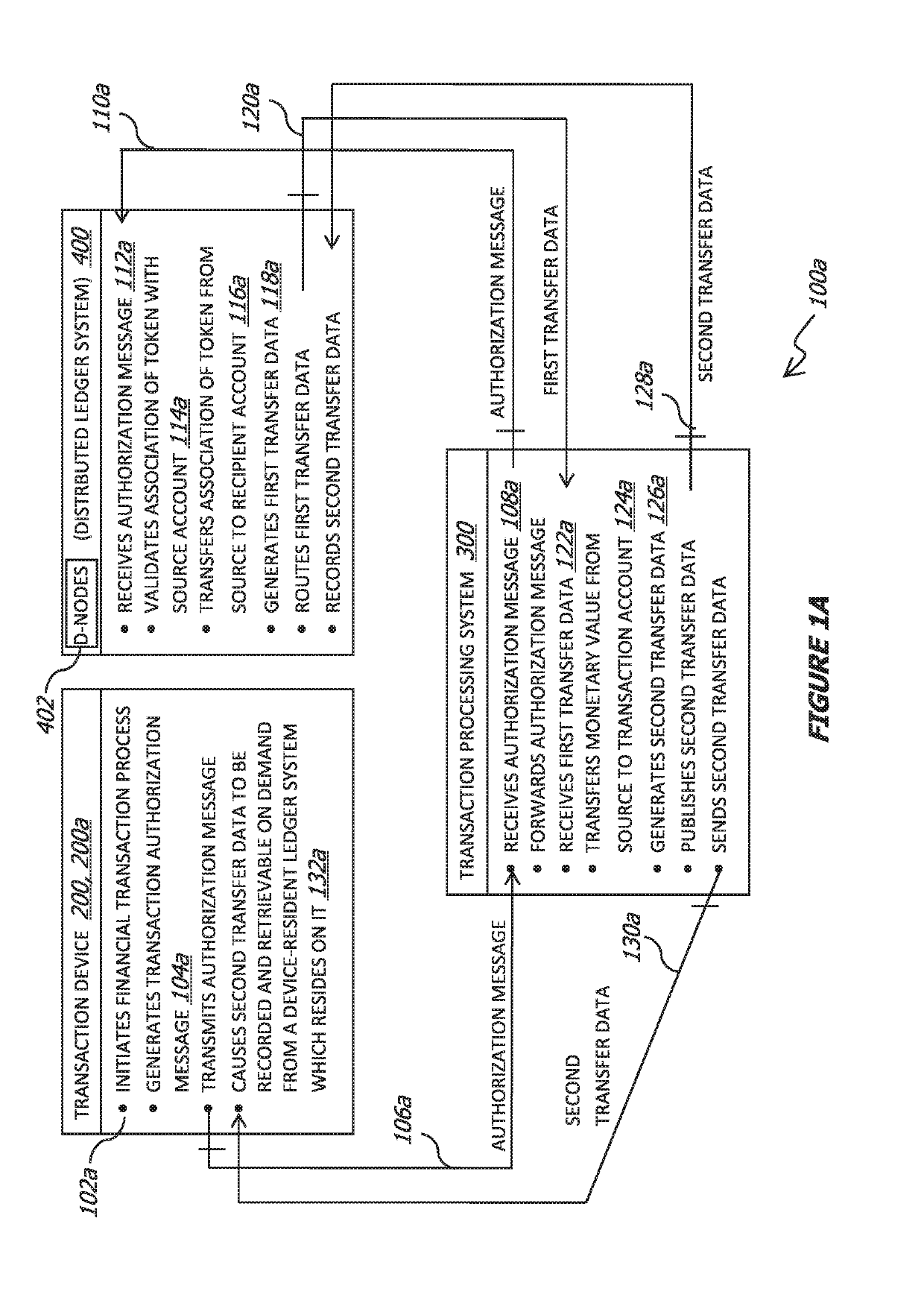

Method of, system for, data processing device, and integrated circuit device for implementing a distributed, ledger-based processing and recording of an electronic financial transaction

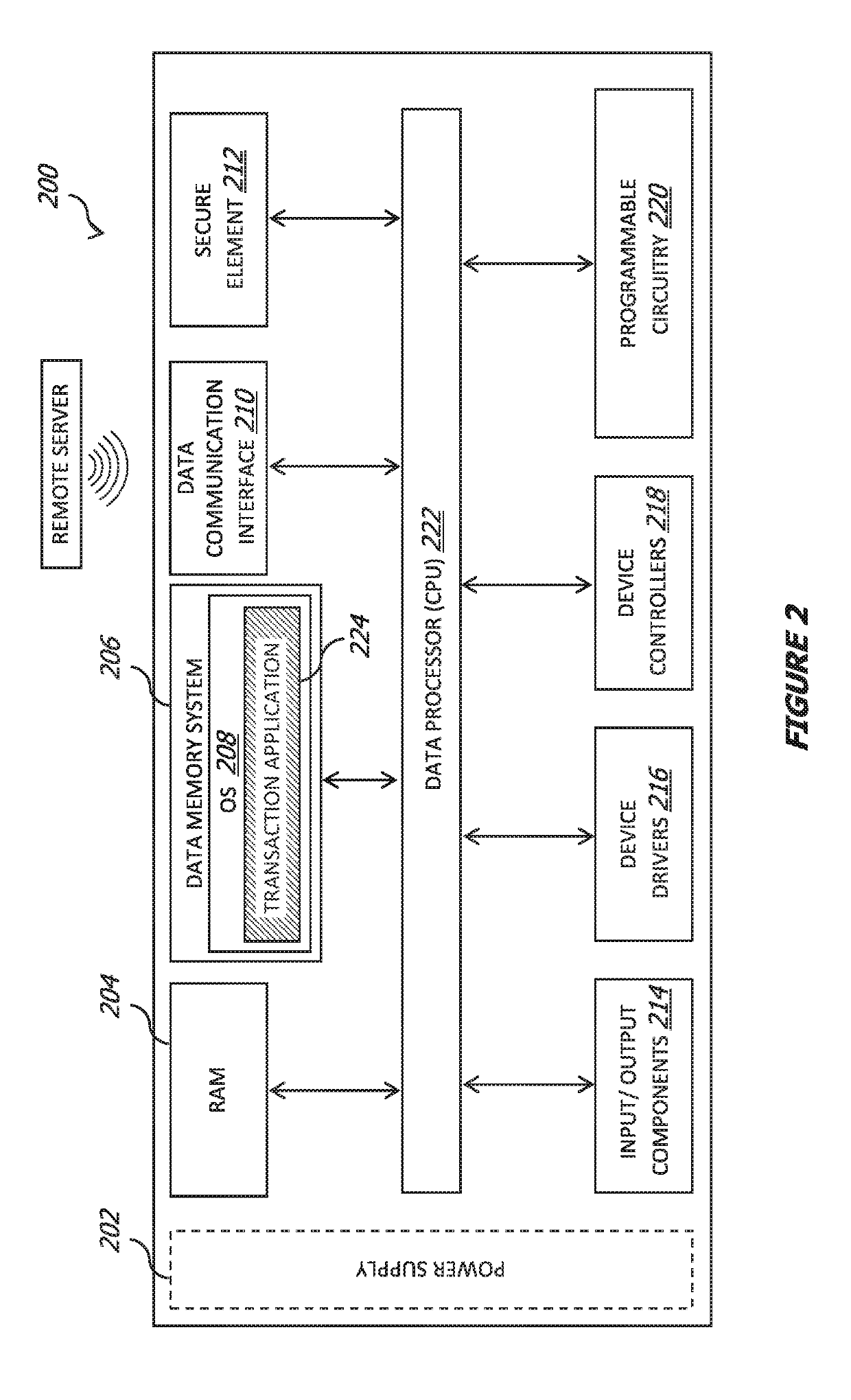

Consistent with one or more aspects of the present invention, there is disclosed a distributed, ledger-based processing and recording of an electronic financial transaction implemented using hardware and / or software application programs and utilizing a device-resident ledger system. Processing and / or recording of the financial transaction can be performed by a transaction processing system which may be any one of a cluster of participating nodes (which may be operated by banks), a third party payment processing system associated with the cluster of participating nodes, and a distributed ledger system associated with the cluster of participating nodes. The may be private ledgers, public ledgers, or hybrids of private and public ledgers. The device-resident ledger system which serves as a digital passbook may be a mirror of an issuer-resident ledger system, may cooperate with the distributed ledger system or similar technology, and may be incorporated into an integrated circuit device (e.g., a chip in a card and NFC-enabled SIM card), which, by itself or incorporated in or linked to other devices like a mobile phone, a POS reader, tablet, computer or similar devices, as well as accessories like a watch, bracelet, eyeglass, ring, pen, or similar devices, can enable and / or implement a financial transaction (e.g., payment and trading).

Owner:VALENCIA RENATO

Loan Analysis And Management System

InactiveUS20140143126A1Easy to explainImprove accessibilityFinanceInformation analysisDocumentation procedure

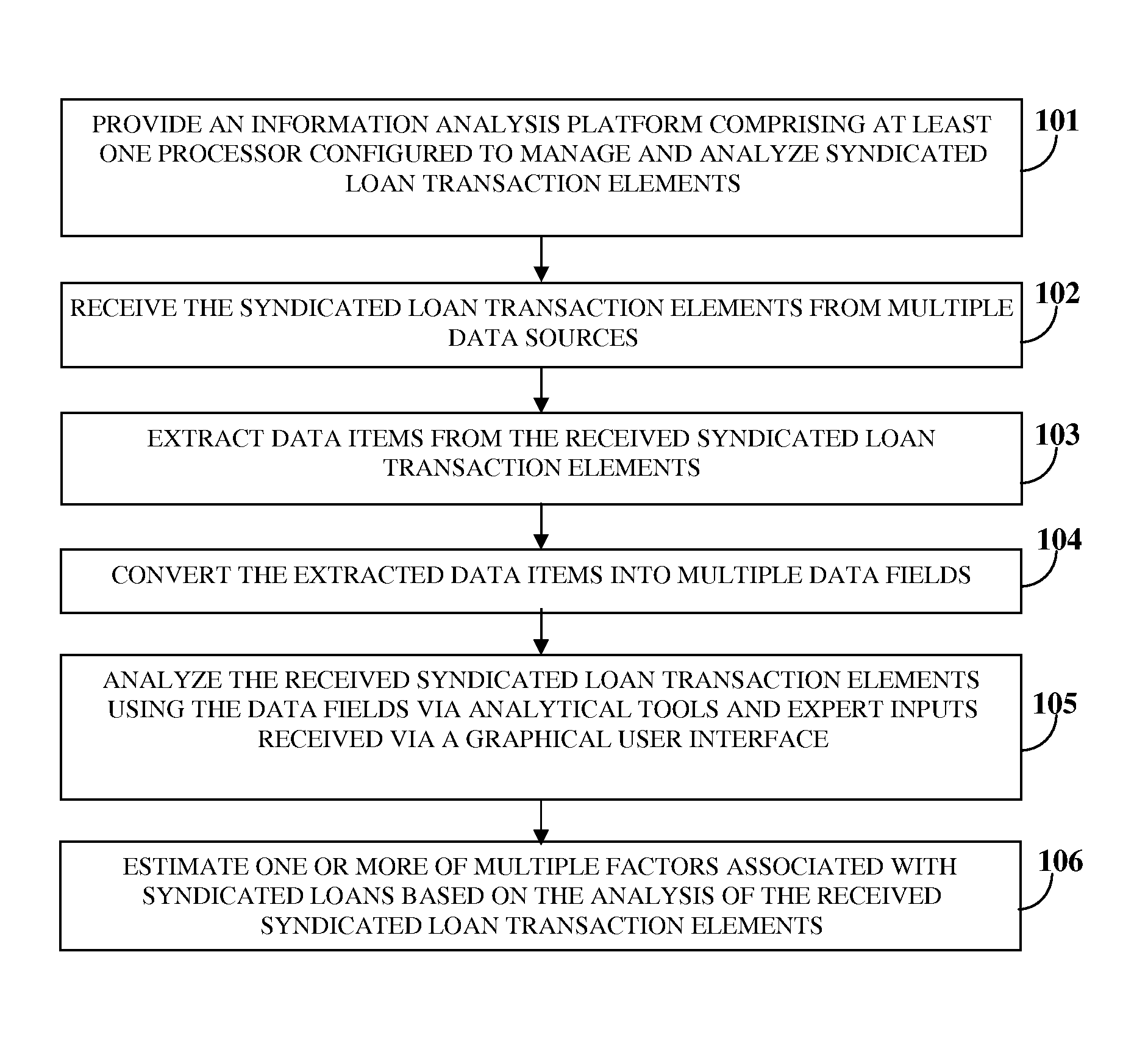

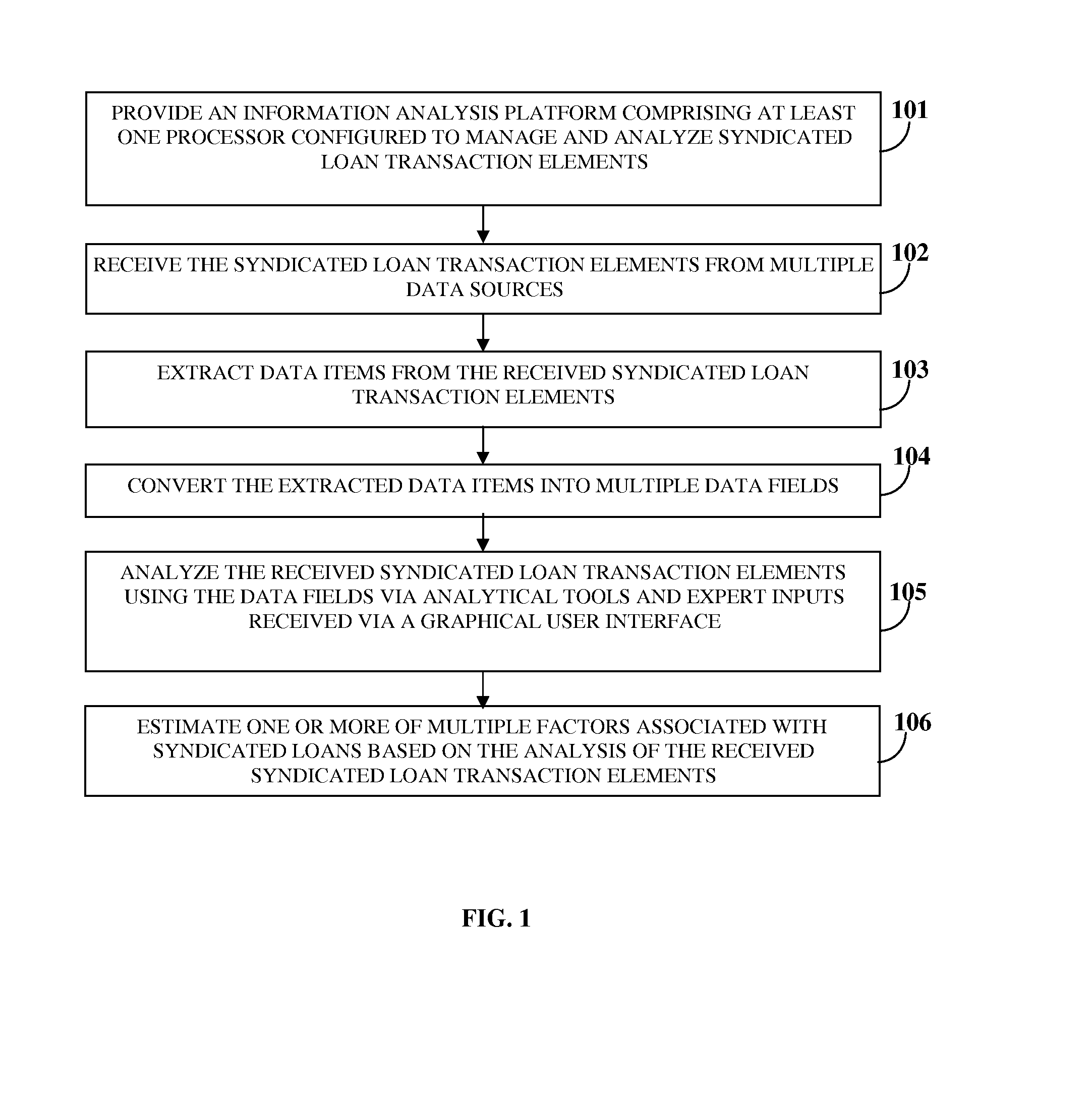

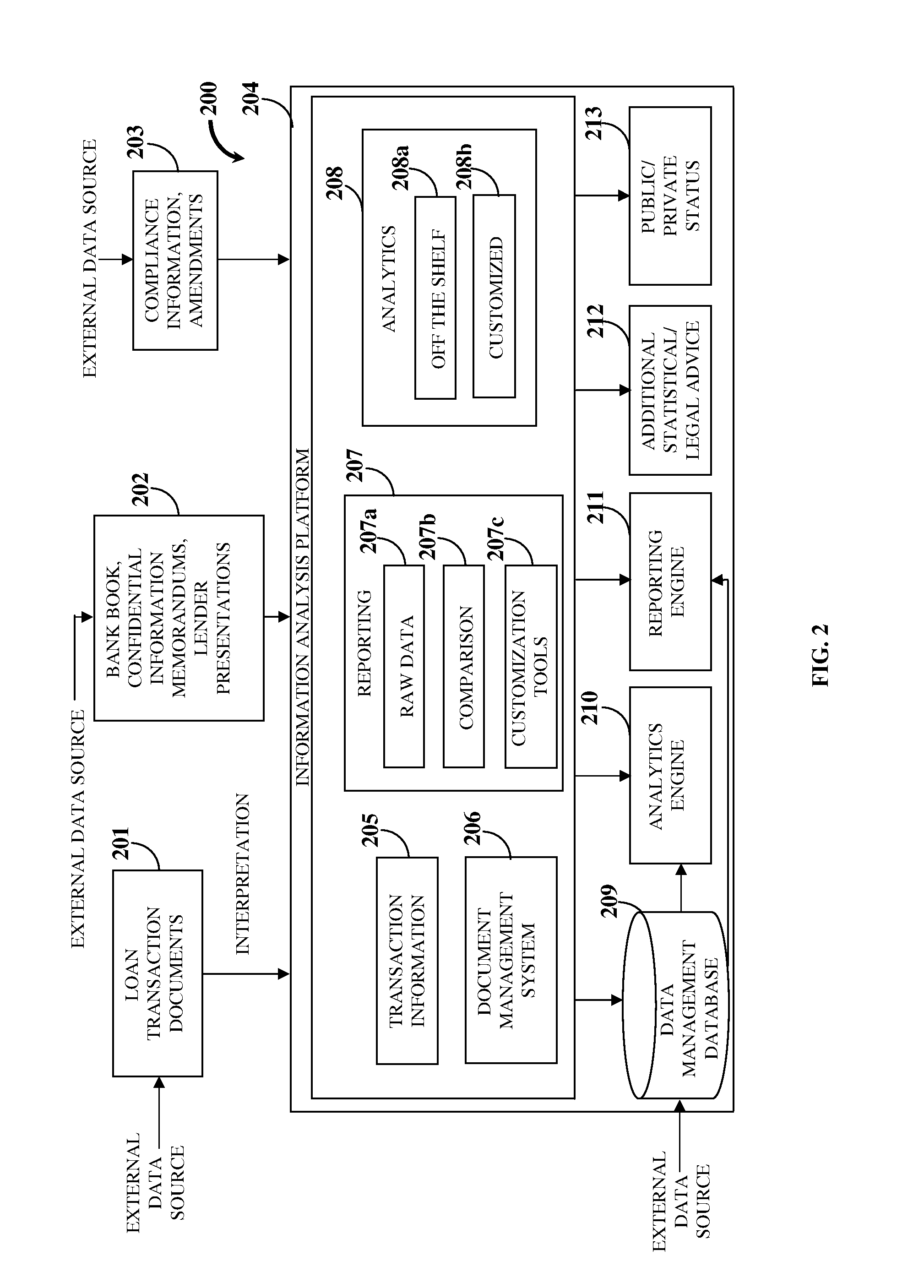

A computer implemented method and a system for analyzing and managing multiple syndicated loan transaction elements, for example, legal loan transaction documents, bank books, compliance reports, etc., are provided. An information analysis platform (IAP) receives the syndicated loan transaction elements from multiple data sources. The IAP extracts data items from the syndicated loan transaction elements and converts the data items into multiple data fields for enhanced review, interpretation, comparison, and statistical analysis of the syndicated loan transaction elements. The IAP analyzes the syndicated loan transaction elements using the data fields via analytical tools and expert inputs received via a graphical user interface, and estimates one or more factors, for example, impact of structural elements on loss given default, probability of default and pricing, impact of each data field for short and long term changes in default and loss given default assumptions, etc., based on the analysis.

Owner:MALIK SHAHEEN

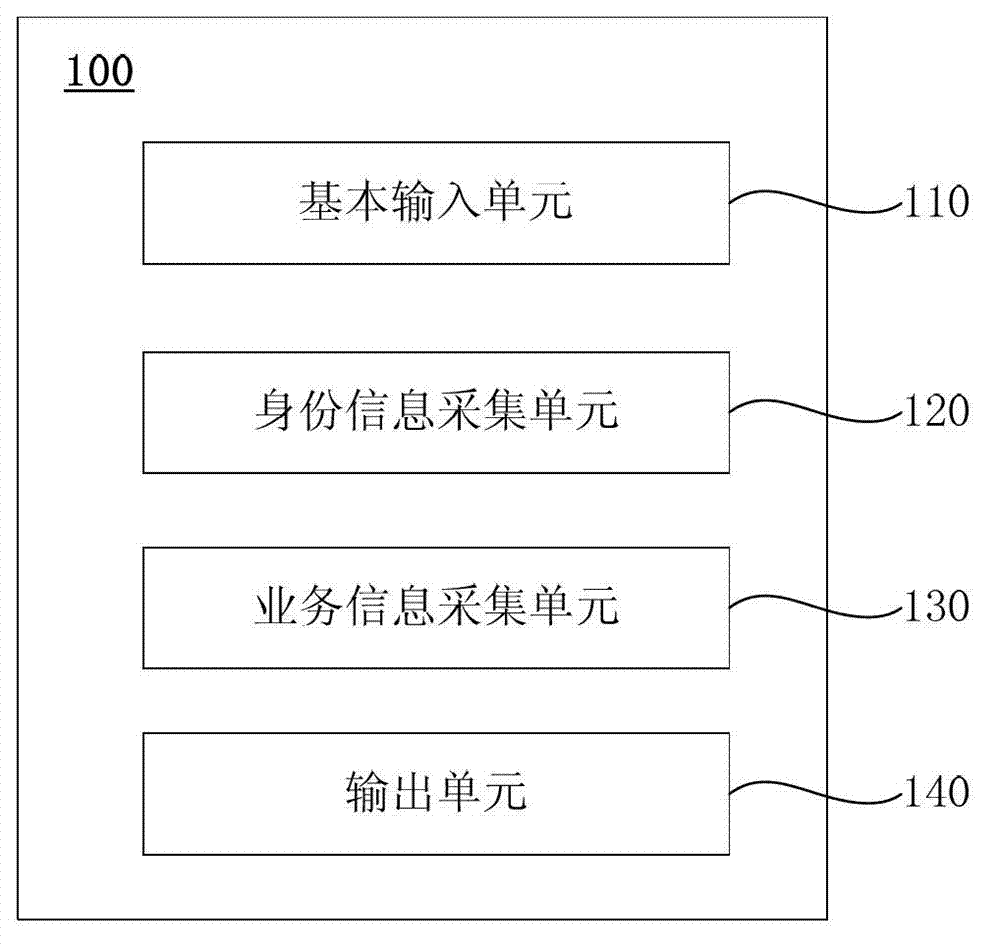

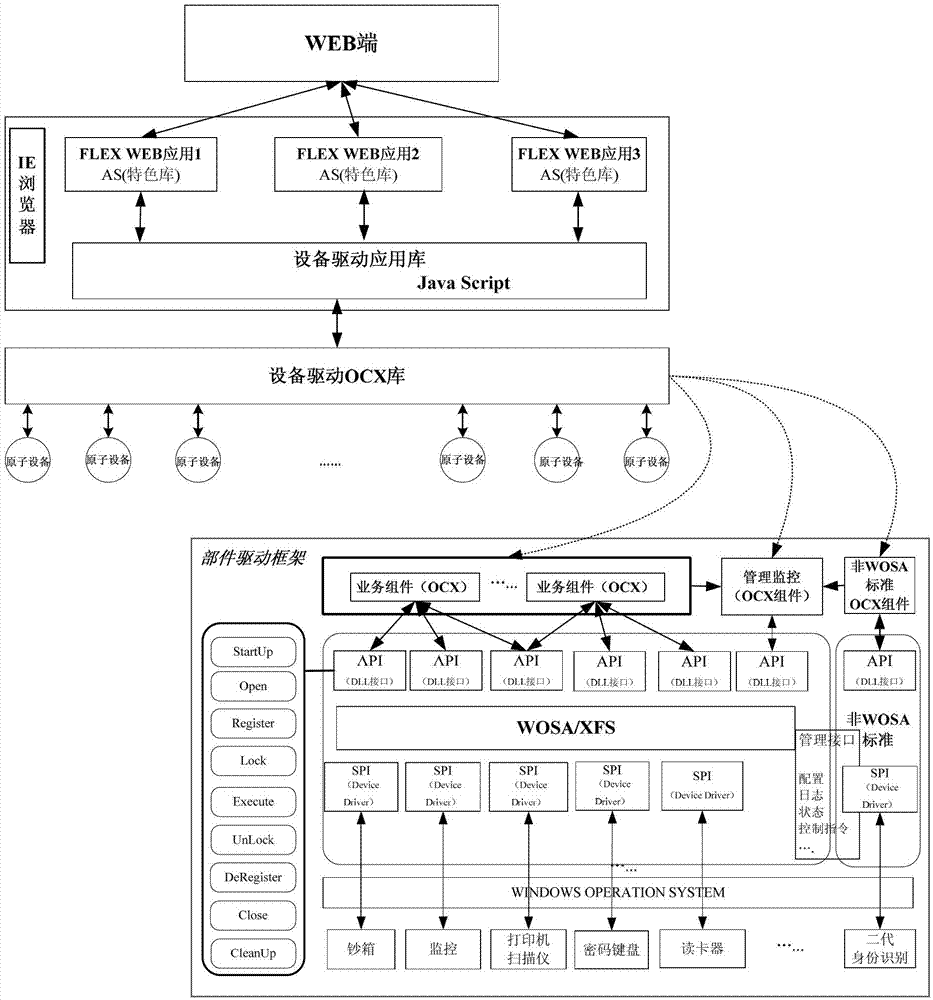

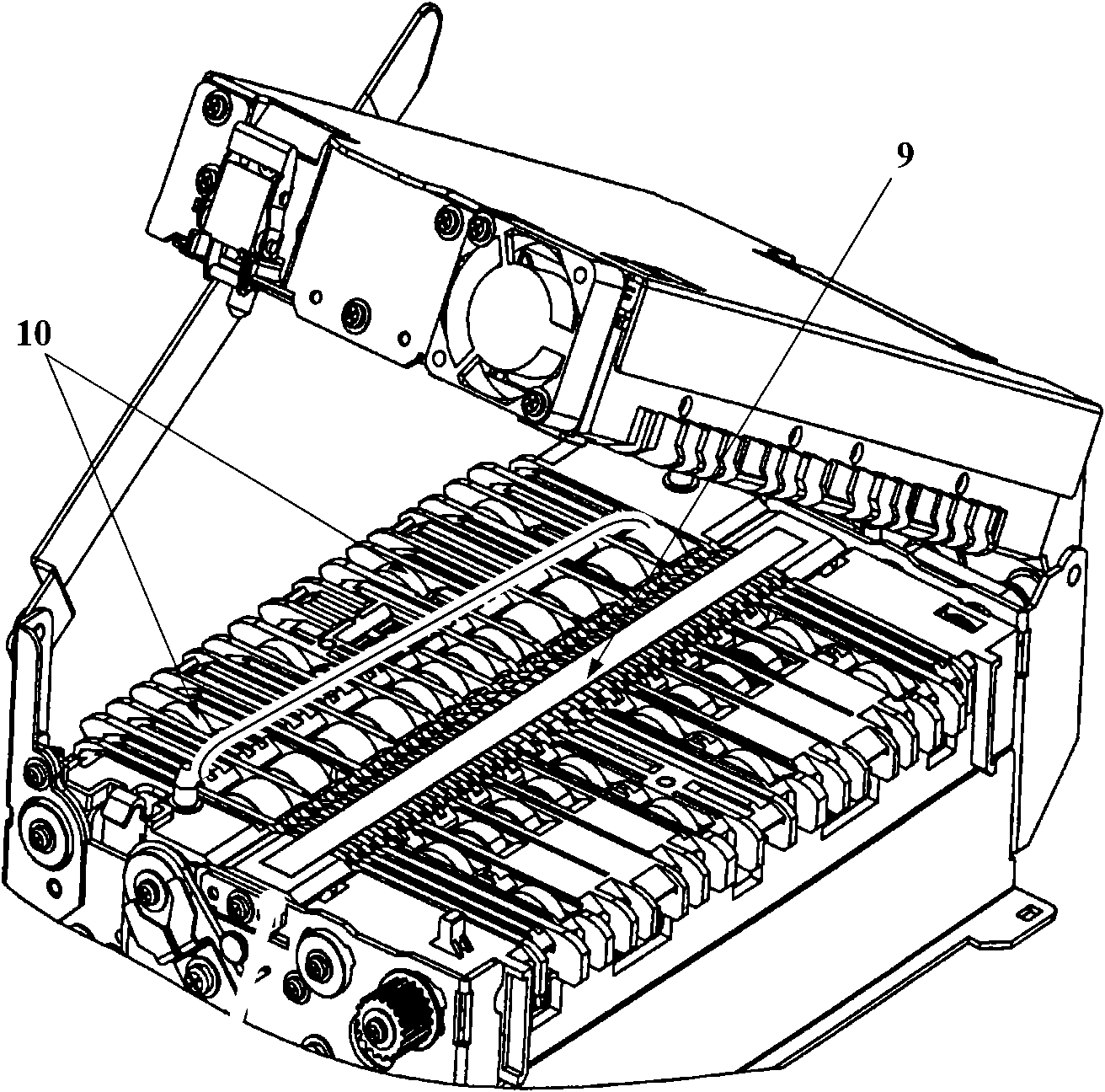

Integrated bank self-service equipment

The embodiment of the invention provides integrated bank self-service equipment. The equipment comprises a basic input unit, an identity information acquisition unit, a service information acquisition unit and an output unit, wherein the basic input unit is used for receiving an operating instruction of a user and reading a bank card inserted by the user and comprises a touch screen, a password keyboard and a bank card reader; the identity information acquisition unit is used for acquiring identity information of the user; the service information acquisition unit is used for acquiring service information related to a private or public bank service and comprises a bank bill scanning and storage module, a passbook reading module and a check reading module; and the output unit is used for outputting service processing information or a processing result related to the private or public bank service and comprises a receipt printer, a journal printer, a passbook printer, a receipt printing and stamping module, a self-service card issuing module and a bank certificate issuing module. The self-service equipment can accept cash / non-cash, domestic currency / foreign currency and private / public bank services and the like.

Owner:BANK OF COMMUNICATIONS

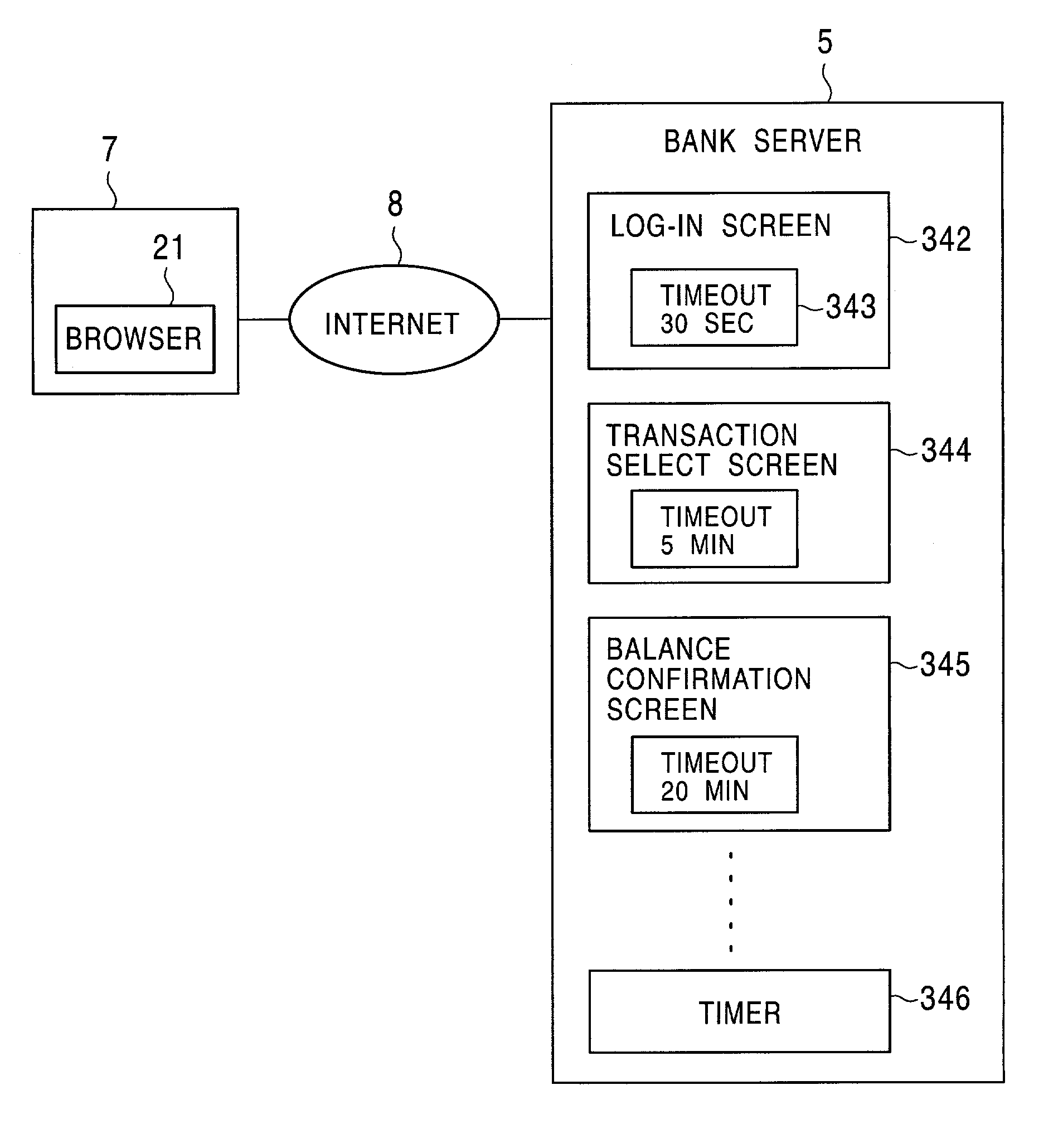

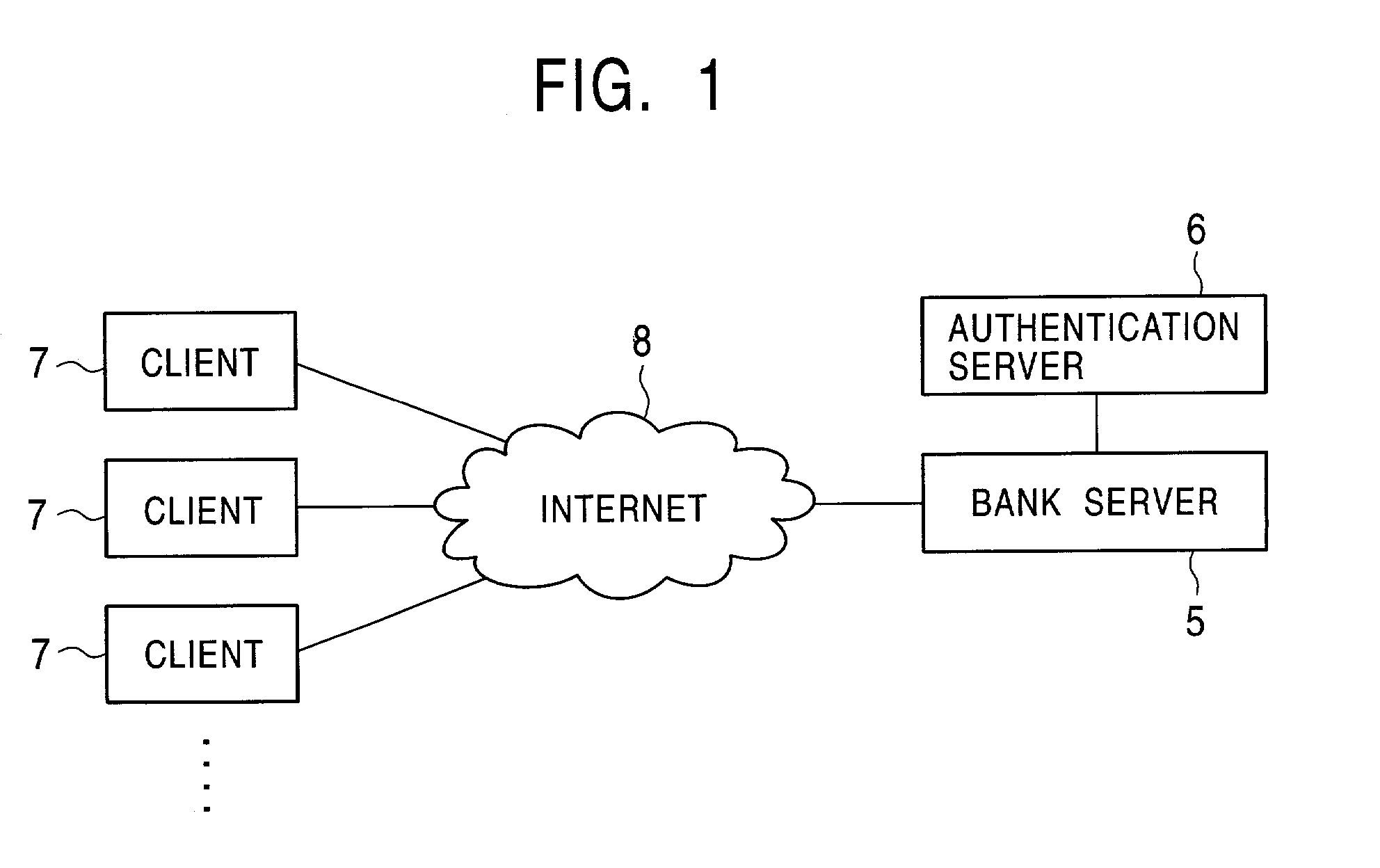

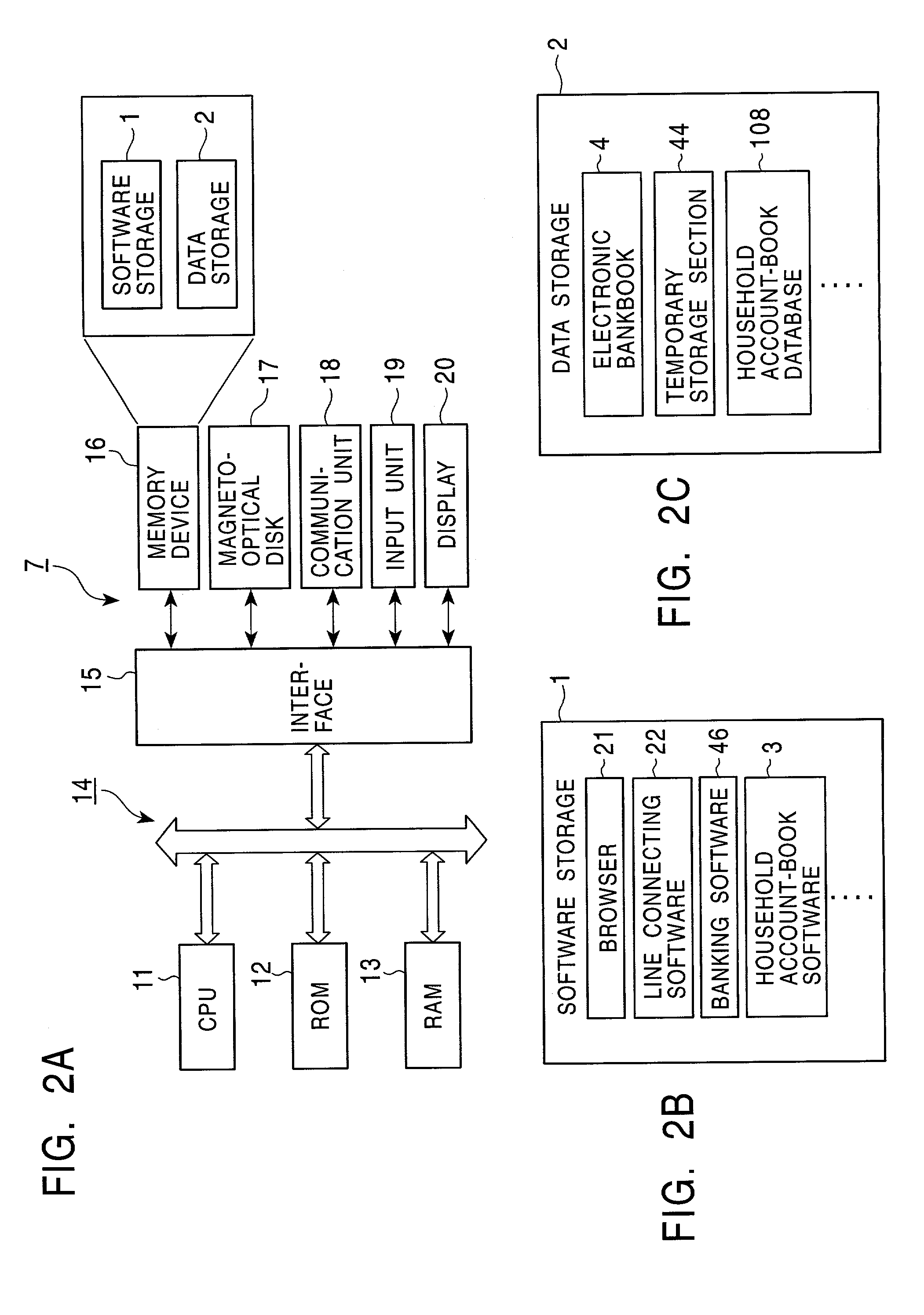

Client terminal device, storage medium product, bank server apparatus, information transmitting method, information transmitting program, and information transmitting/receiving program

The invention provides an Internet banking system which can present services more familiar to daily life of individual users, and a bank server apparatus, etc. which can limit available banking services depending on user attributes. From the viewpoint of security, the invention reduces risks of information leak from a client terminal device to third persons and unauthorized accesses from third persons. Banking software for connection to the bank server apparatus is installed in the client terminal device. The banking software can display a screen transfer, etc. in the off-line condition. The banking software prepares transaction instruction data from information entered by the user on the displayed screen and temporarily holds it in the client terminal device. When the client terminal device is connected to the bank server apparatus, the held data is uploaded to the bank server apparatus. In the client terminal device, application software can be utilized in linkage with the banking software so as to display the contents of an electronic bankbook. As examples of the application software, household account-book software, petty cashbook software, etc. can be provided to users.

Owner:SONY CORP

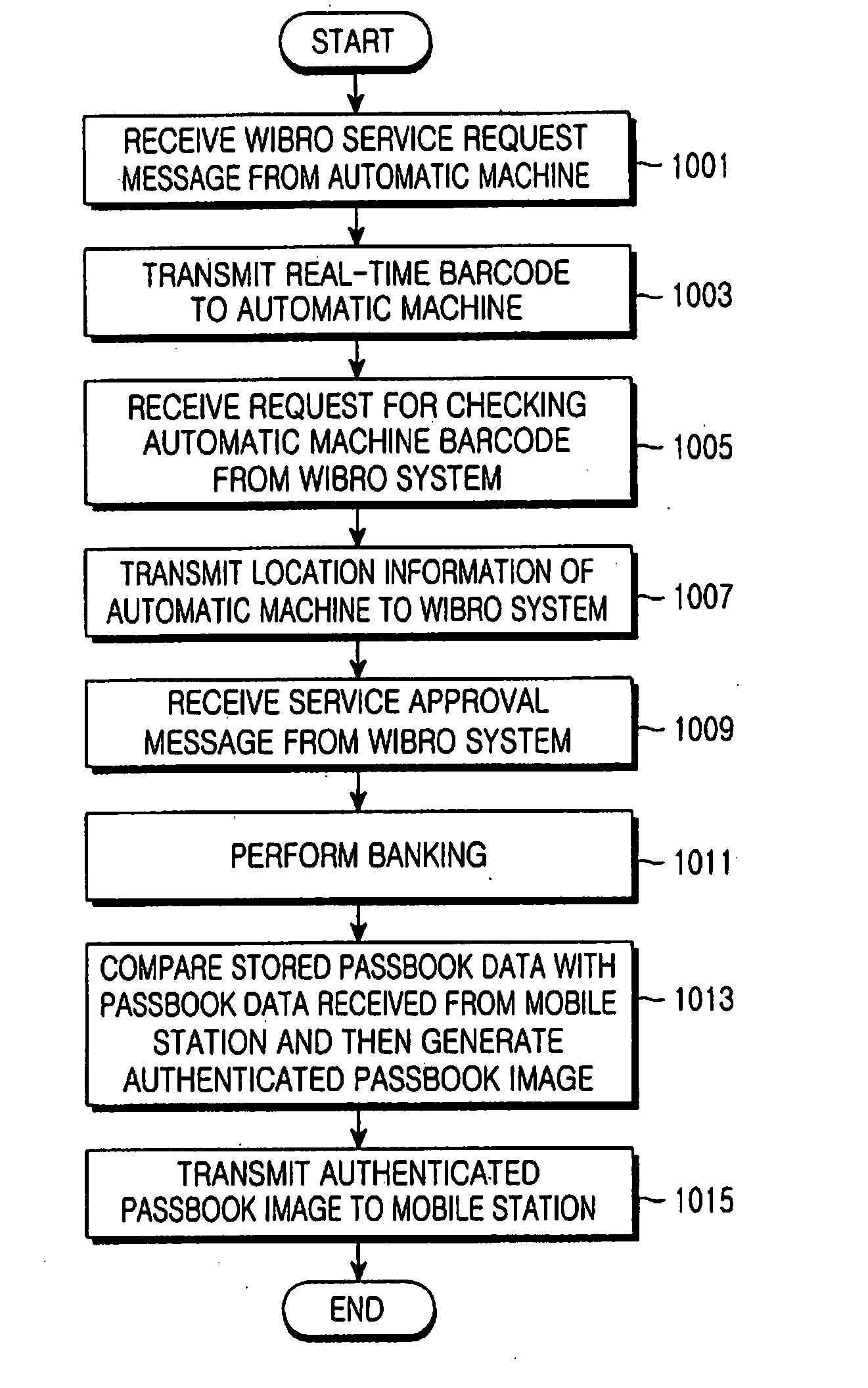

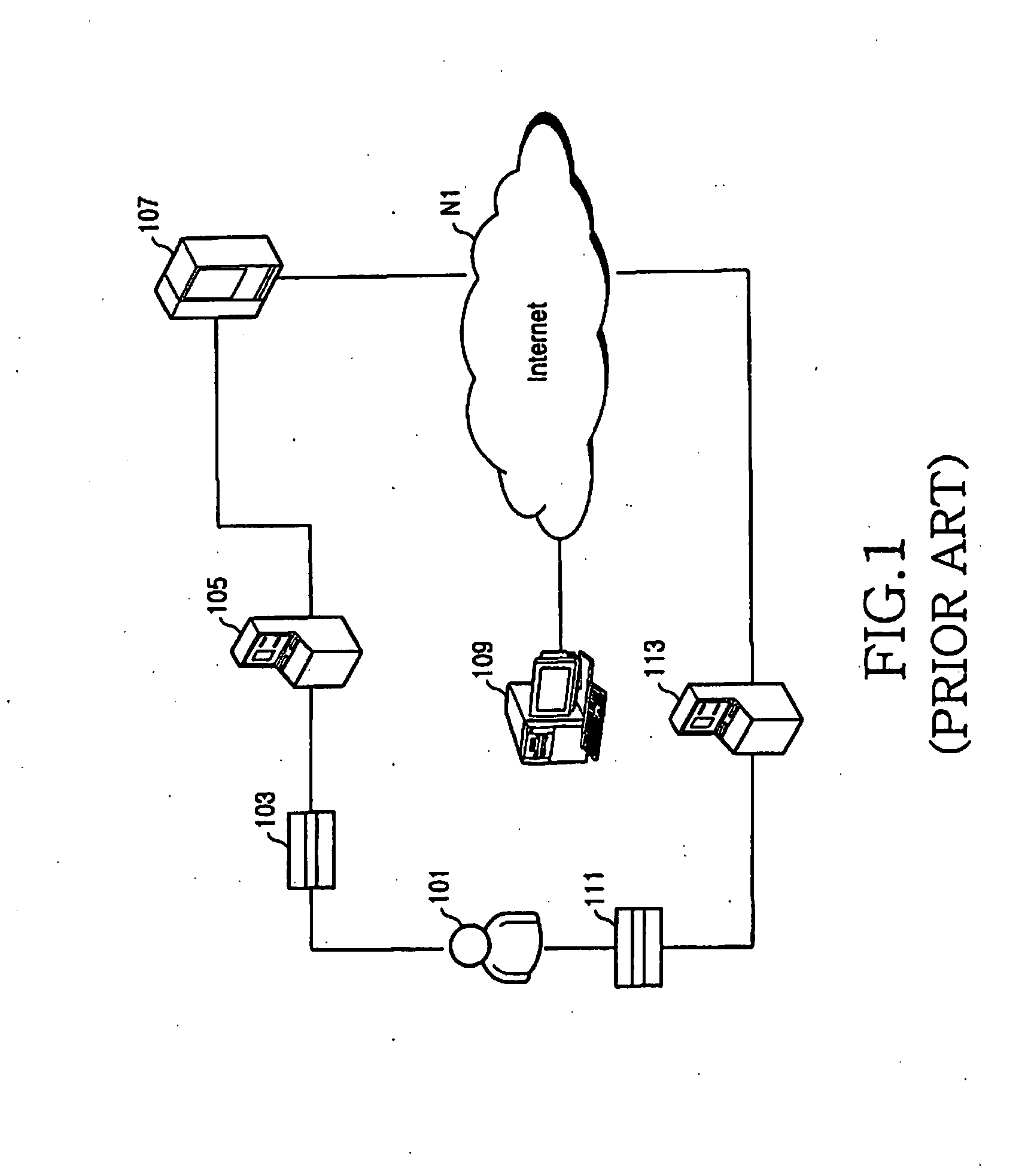

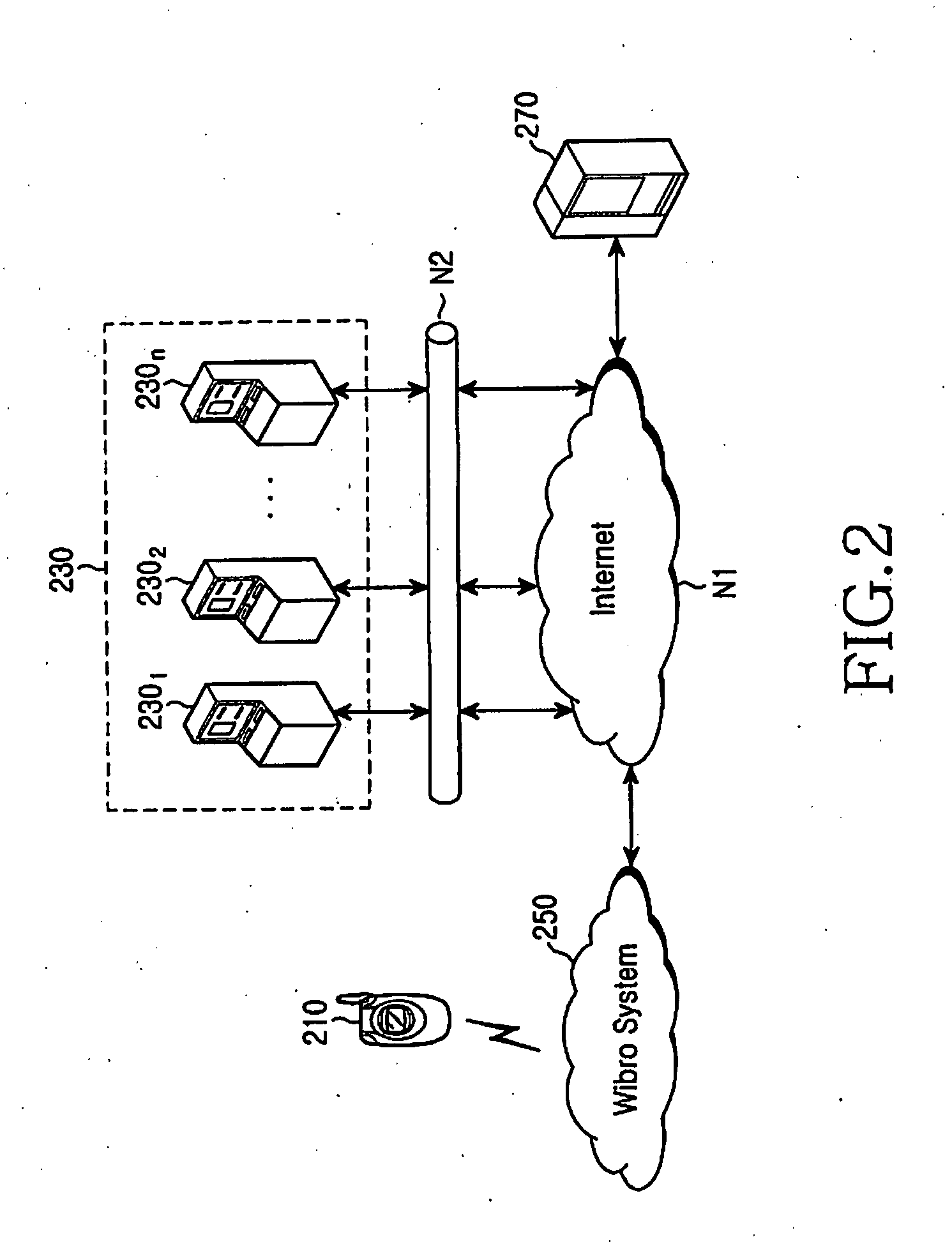

Method, apparatus and system for providing financial service by using mobile station in packet data system

Disclosed is a method, apparatus and system for providing a financial service through a mobile station in a mobile communication network. The system includes the mobile station for reading a barcode, transmitting user authentication data and the barcode, receiving passbook data, and storing and managing the passbook data; the mobile communication network for receiving the user authentication data and the barcode to thereby provide barcode information to a bank server, determining whether to approve the service; the bank server for managing the passbook data, allocating a specific barcode to each automatic machine, providing the location information of the automatic machine, corresponding to the barcode, and providing the mobile station with a banking service; and the automatic machine for receiving the barcode and outputting the received barcode, and providing the banking service through the bank server when the service is approved.

Owner:SAMSUNG ELECTRONICS CO LTD

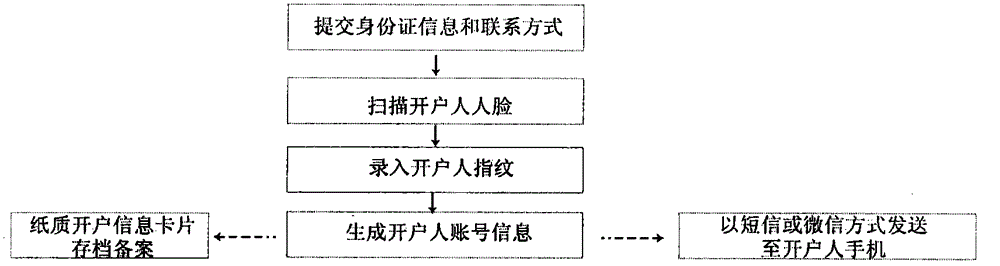

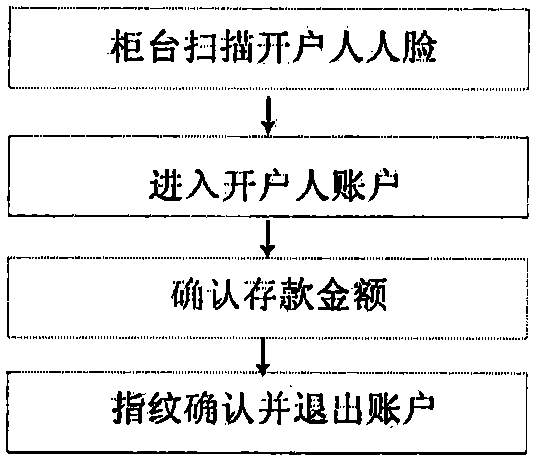

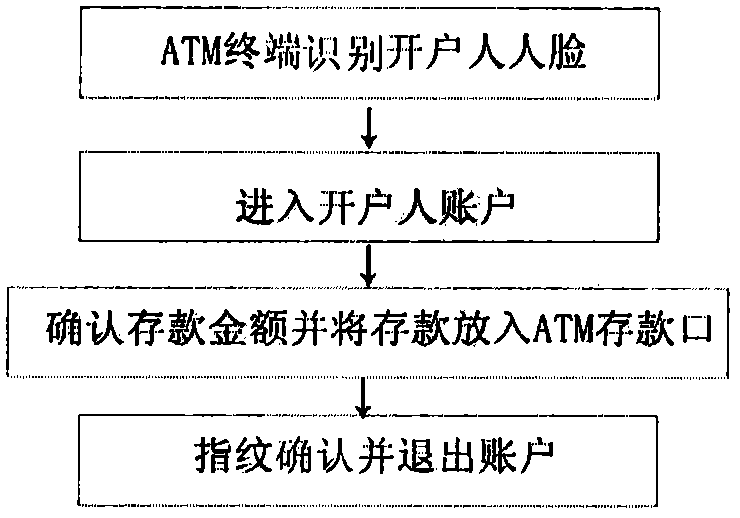

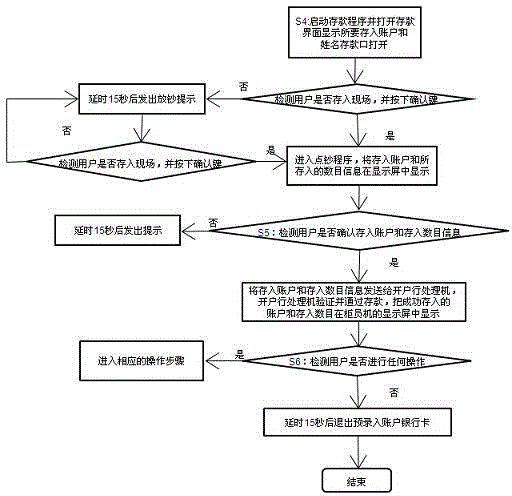

Bank system adopting human face recognition to enter account and confirming service through fingerprint

The invention discloses a bank system adopting human face recognition to enter an account and confirming service through a fingerprint. An account holder submits ID card information and contact information in the case of account opening, the bank scans the face of the account holder, the fingerprint of the account holder is recorded, and account holder account information is generated; through the human face recognition mode, the account holder performs selective operation of deposit, payment, information change or other service dealing, after the operation is completed, the above operation is confirmed by the fingerprint of the account holder, deposit, payment, information change or other service dealing can be completed, and the account of the account holder is quitted. The system of the invention has the advantages that the account holder can quickly and safely enter the bank service dealing with no need of carrying a deposit passbook, a bank card and a password, the operation is simple, convenient and quick, safety of the account has dual assurance, and as the bank service can only be handled at a counter or an ATM terminal, capital safety caused by crime can be effectively prevented.

Owner:罗卫东

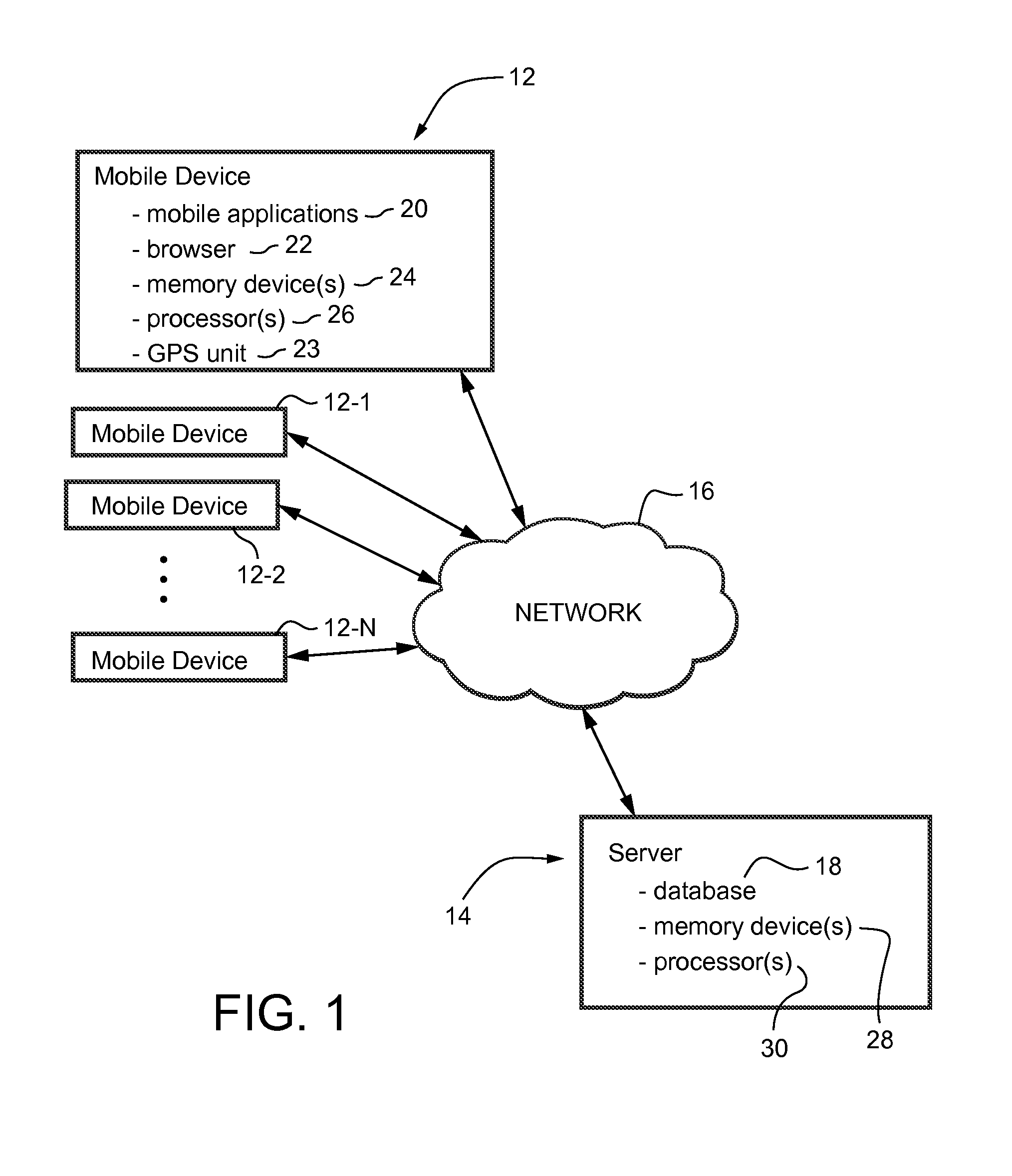

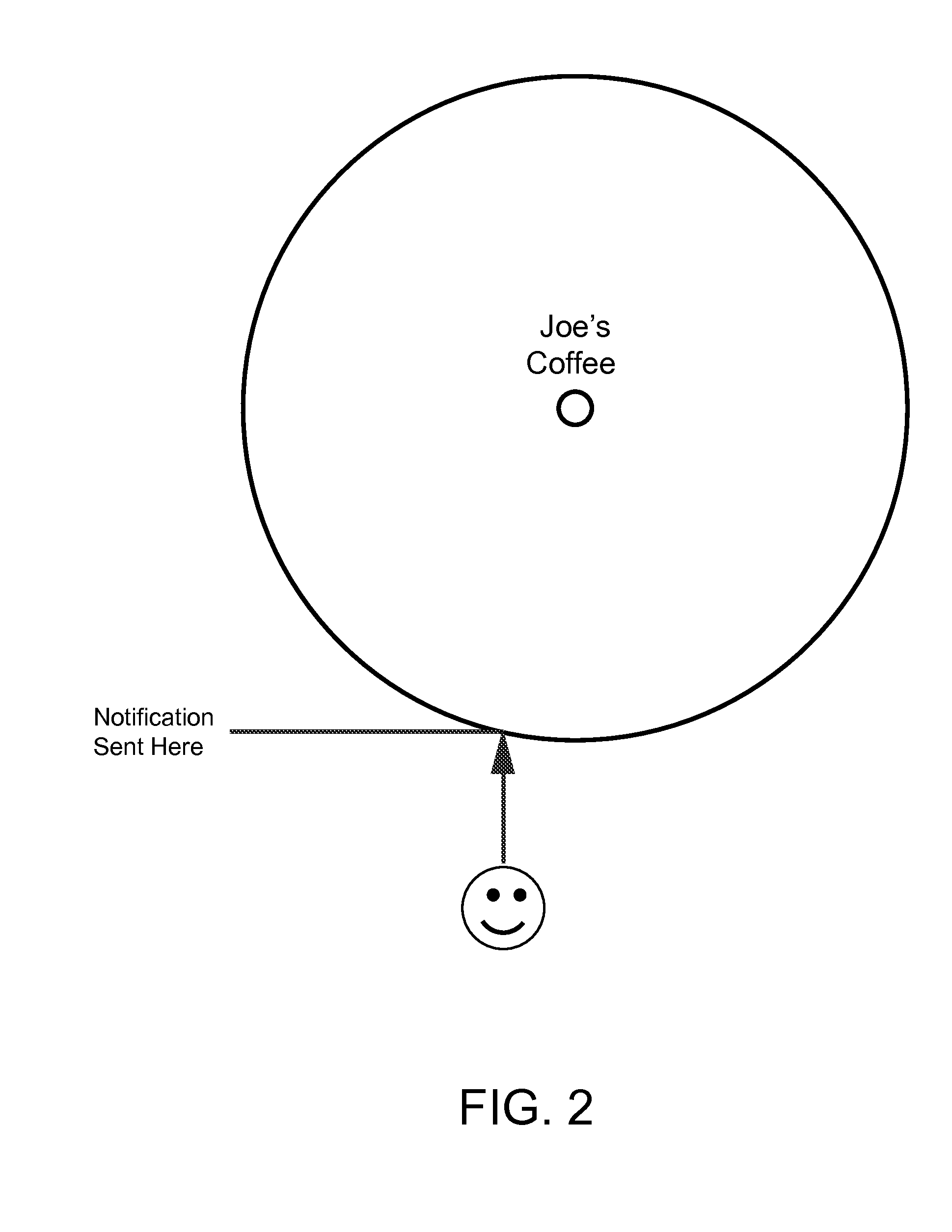

ADMINISTERING AN eREWARDS PROGRAM USING DYNAMIC GEO-FENCING

InactiveUS20150199704A1Improve customer satisfactionPromoting a higher percentage redemptionMarketingPassbookClient-side

Utilizing geo-fencing technology on mobile devices, notifications are sent to a user when they enter a variable sized radius of a merchant offering an eReward. The notification may allow the user to redeem the reward directly from the notification, by allowing the user to confirm their intent and causing the user to receive a terms and conditions alert. Once the terms and conditions alert is accepted, the user will hit a website end-point that will deduct the points from the eRewards account and present the eReward to the mobile client device, e.g., into a “passbook” or the like. In a preferred embodiment, only users with the capability to purchase the reward will be notified, and users will be able to one-step redeem the award from the notification itself.

Owner:FISOC

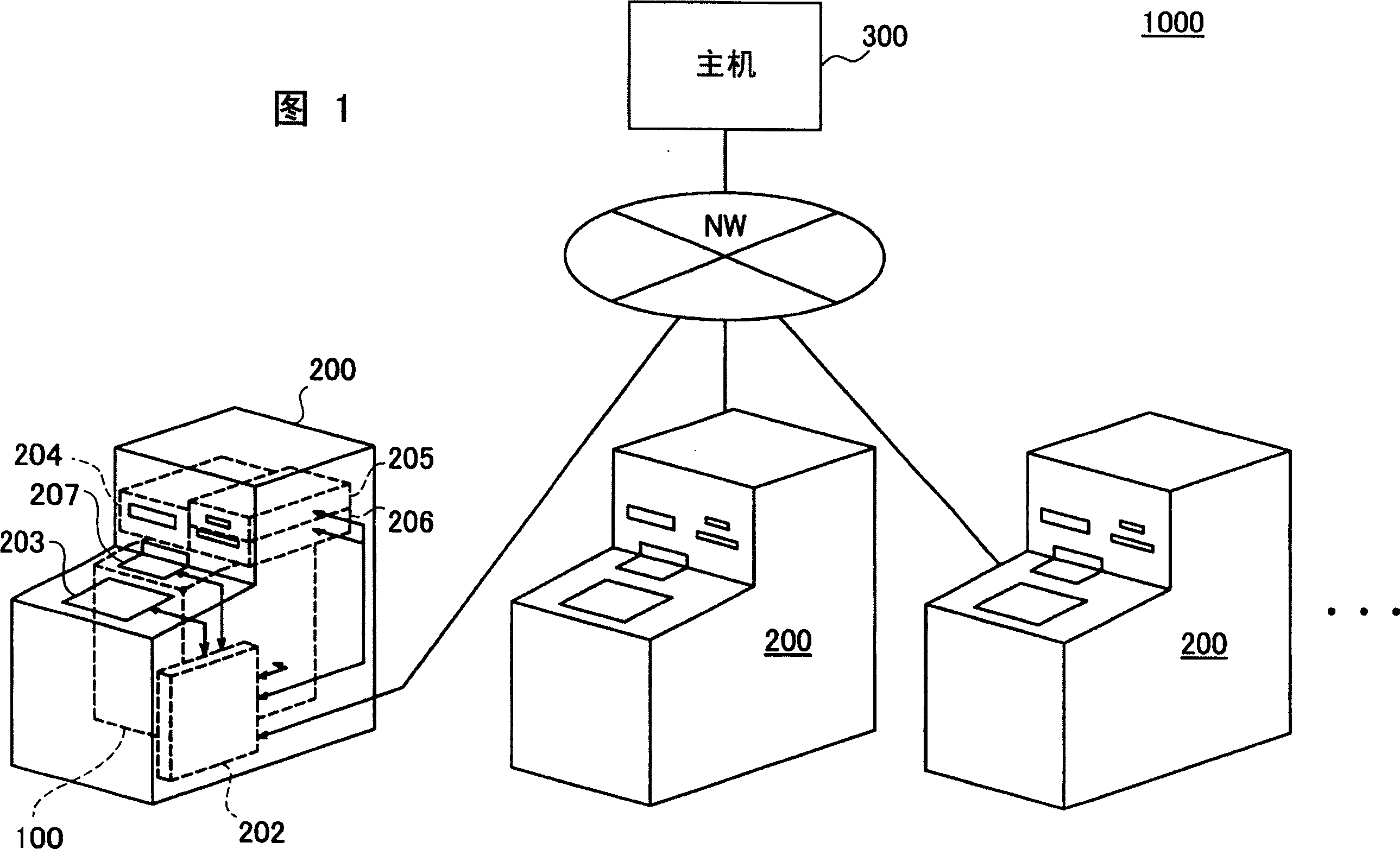

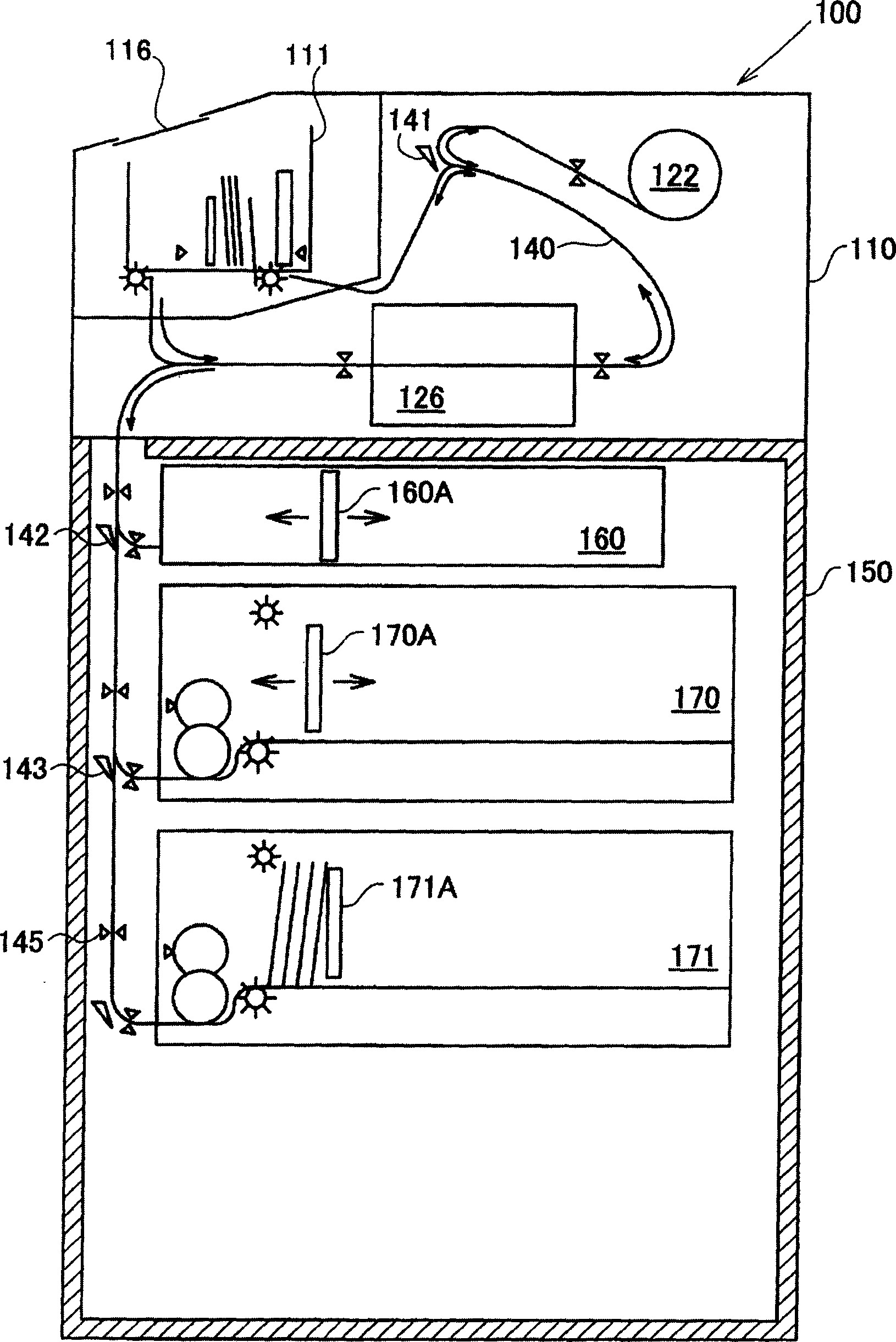

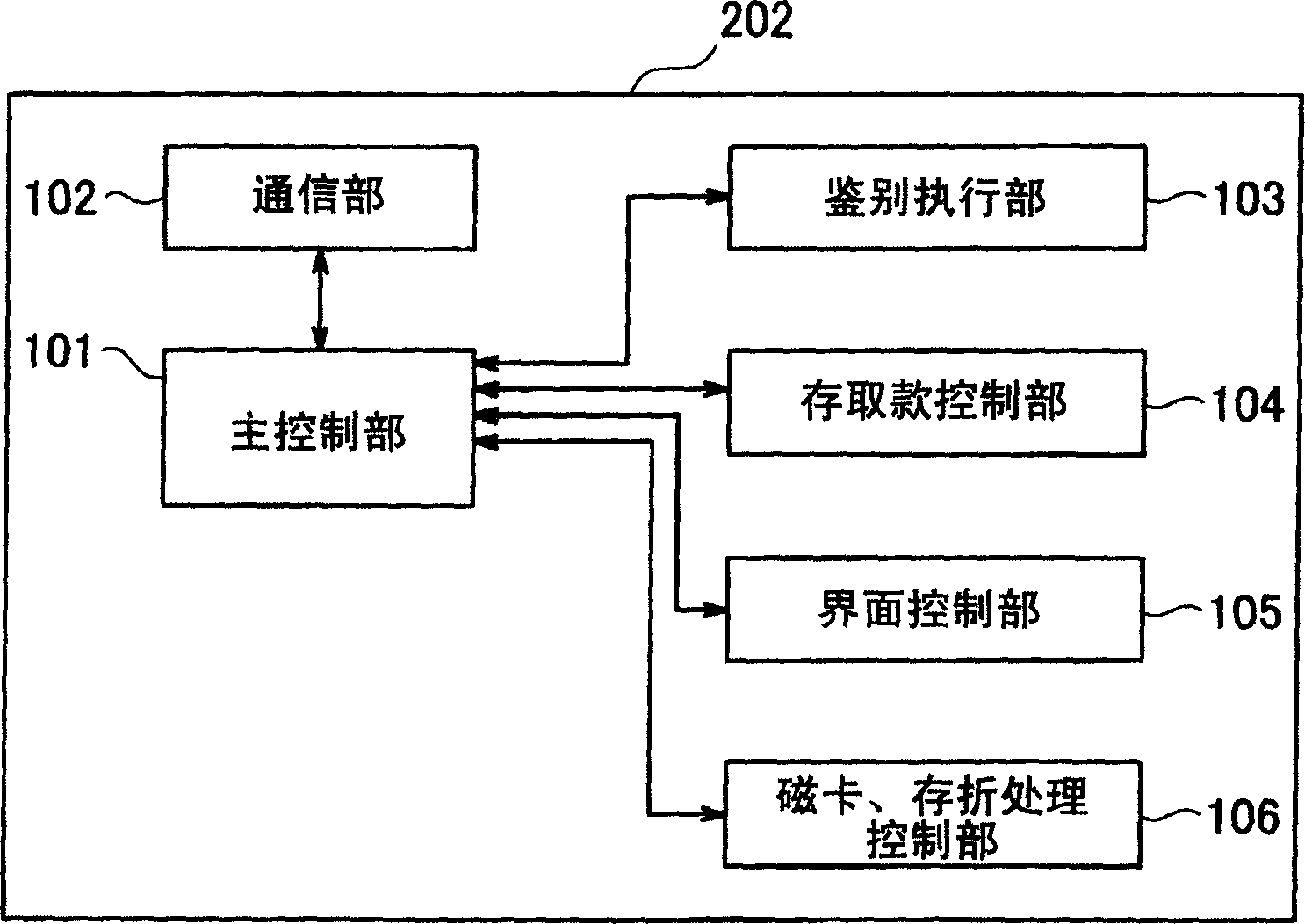

Automatic transaction device, system and its control method

The purpose of the invention is to effectively keep a user from repeatedly trying to insert counterfeit bills into an automated teller machine that allows transactions such as paying or receiving money by means of a transaction medium such as a card and a bank book. The automated teller machine comprises a counting part for counting the number of times that the counterfeit bill is inserted, when adiscrimination part discriminates the counterfeit bills; a control unit for controlling a medium processing entity to keep the user from repeatedly trying to insert counterfeit bills into the automated teller machine, when the number exceeds the preset value.

Owner:HITACHI OMRON TERMINAL SOLUTIONS CORP

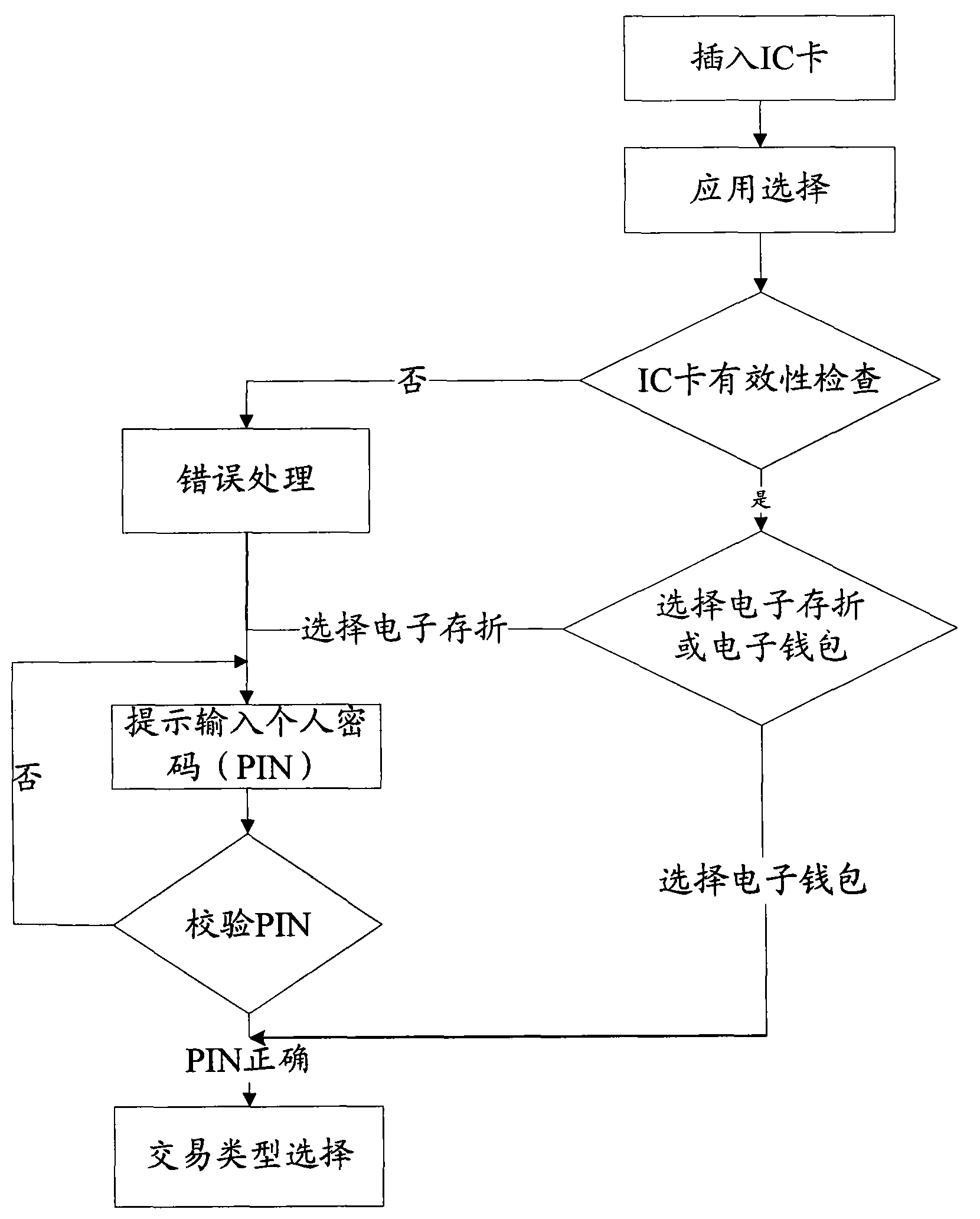

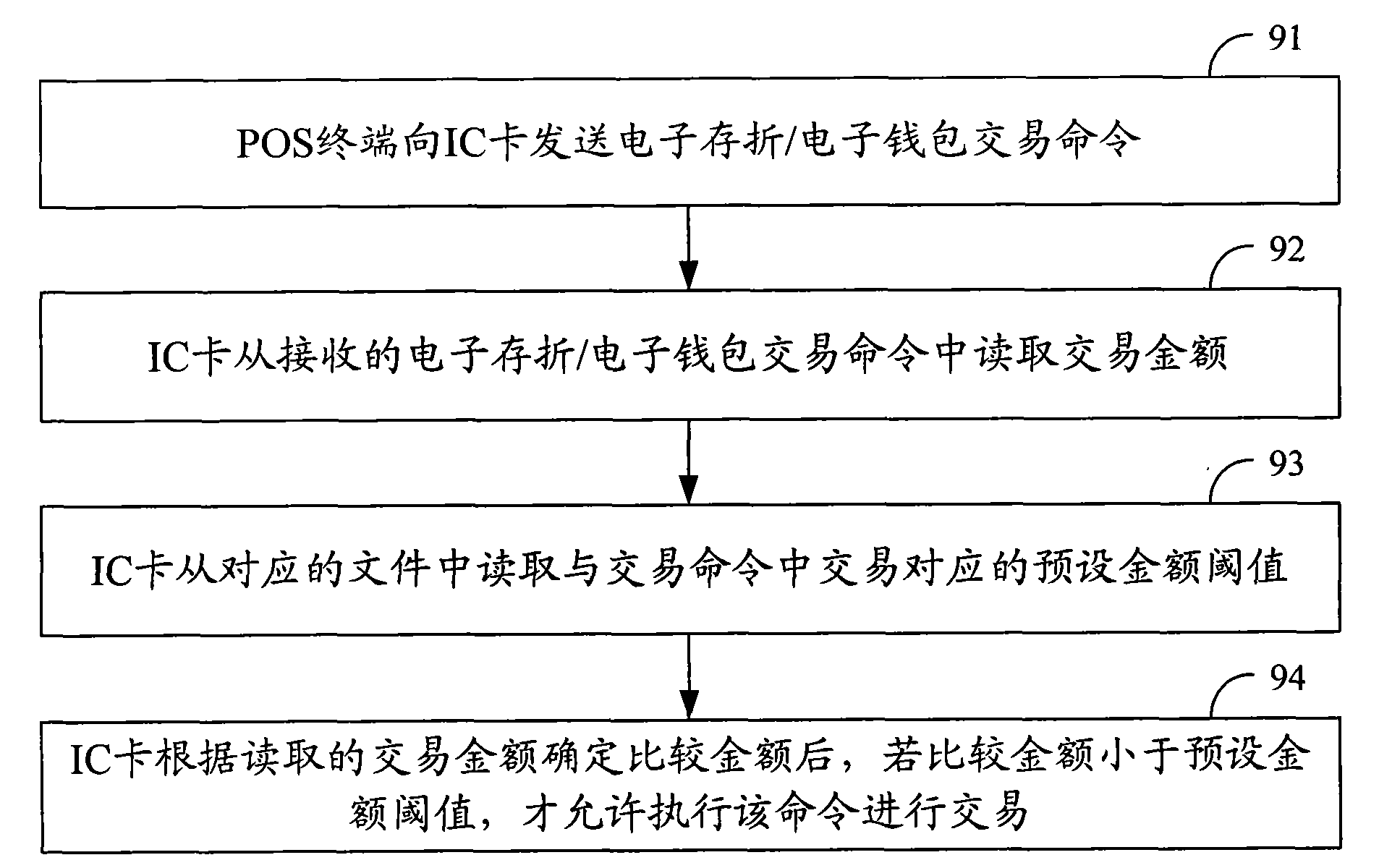

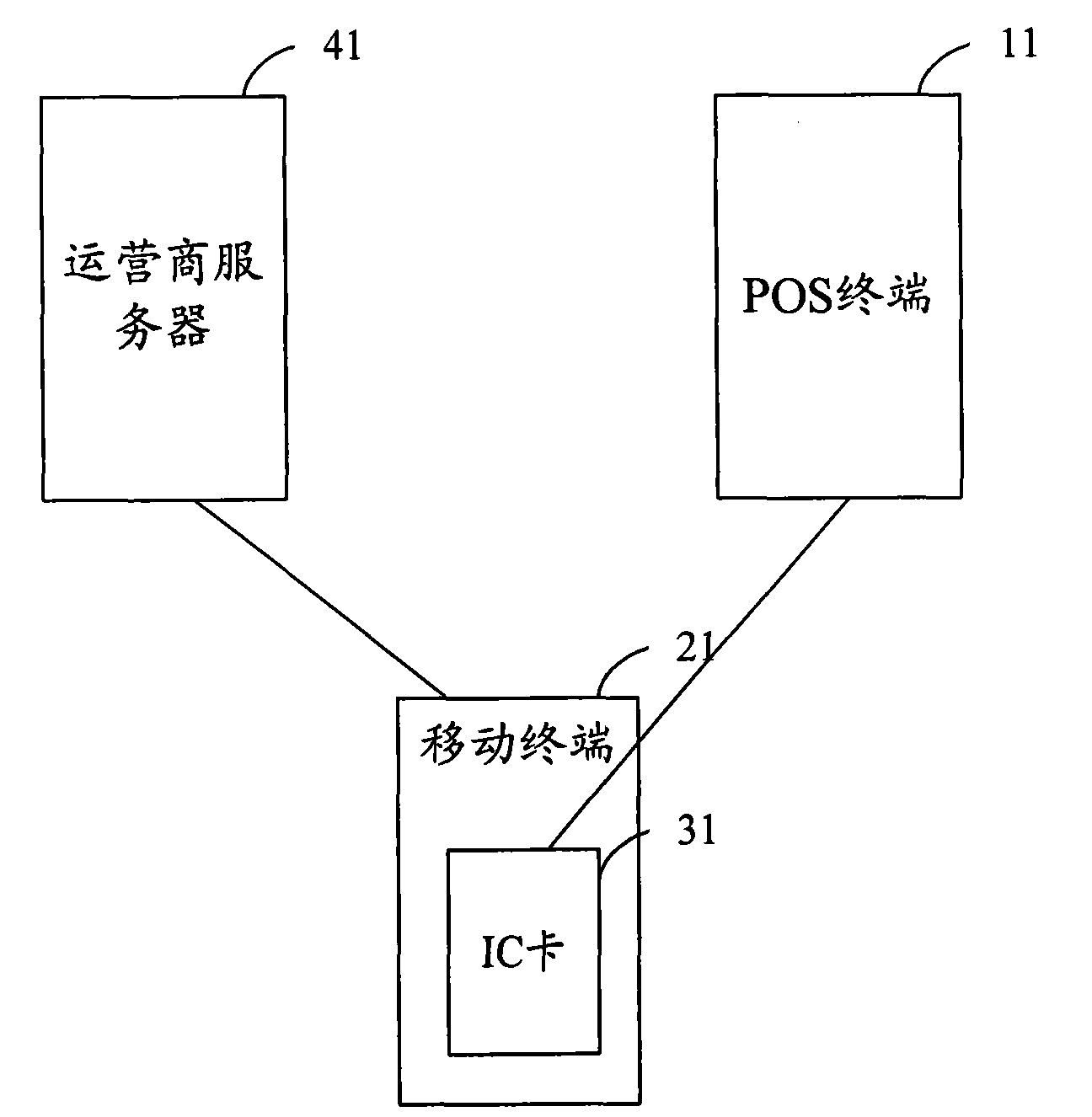

IC card and method for realizing electronic wallet/electronic passbook transaction

InactiveCN101673432AAvoid mistakesPerfect passbook transaction processCoded identity card or credit card actuationPassbookOperating system

The invention discloses an IC card and a method for realizing electronic wallet / electronic passbook transaction and aims at solving the problem that the existing process for realizing electronic wallet / electronic passbook transaction is not perfect. The disclosed method for realizing electronic wallet / electronic passbook transaction includes the following steps: an integrated circuit IC card readstransaction amount from a received electronic passbook / electronic wallet transaction command; the IC card reads the preset amount threshold that corresponds to the transaction of the transaction command; and according to the read transaction amount, the IC card determines compare amount, when the compare amount is not more than the preset amount threshold, the command is allowed to be executed for conducting transaction. As the command is only allowed to be executed for implementing transaction when the compare amount is not more than the preset amount threshold, errors during subsequent treatment process are avoided and therefore the process of electronic wallet / electronic passbook transaction is more perfect.

Owner:BEIJING WATCH DATA SYST

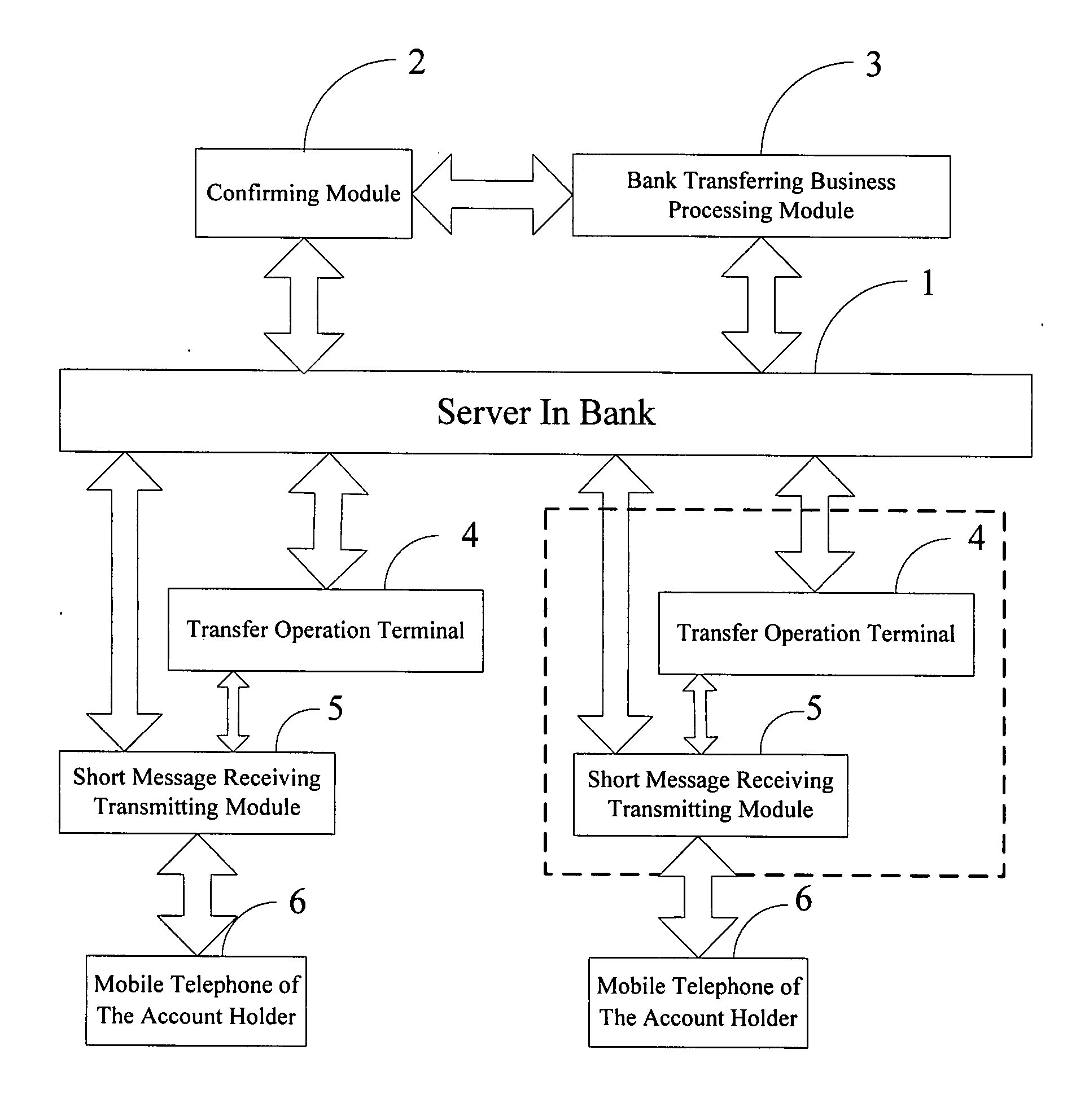

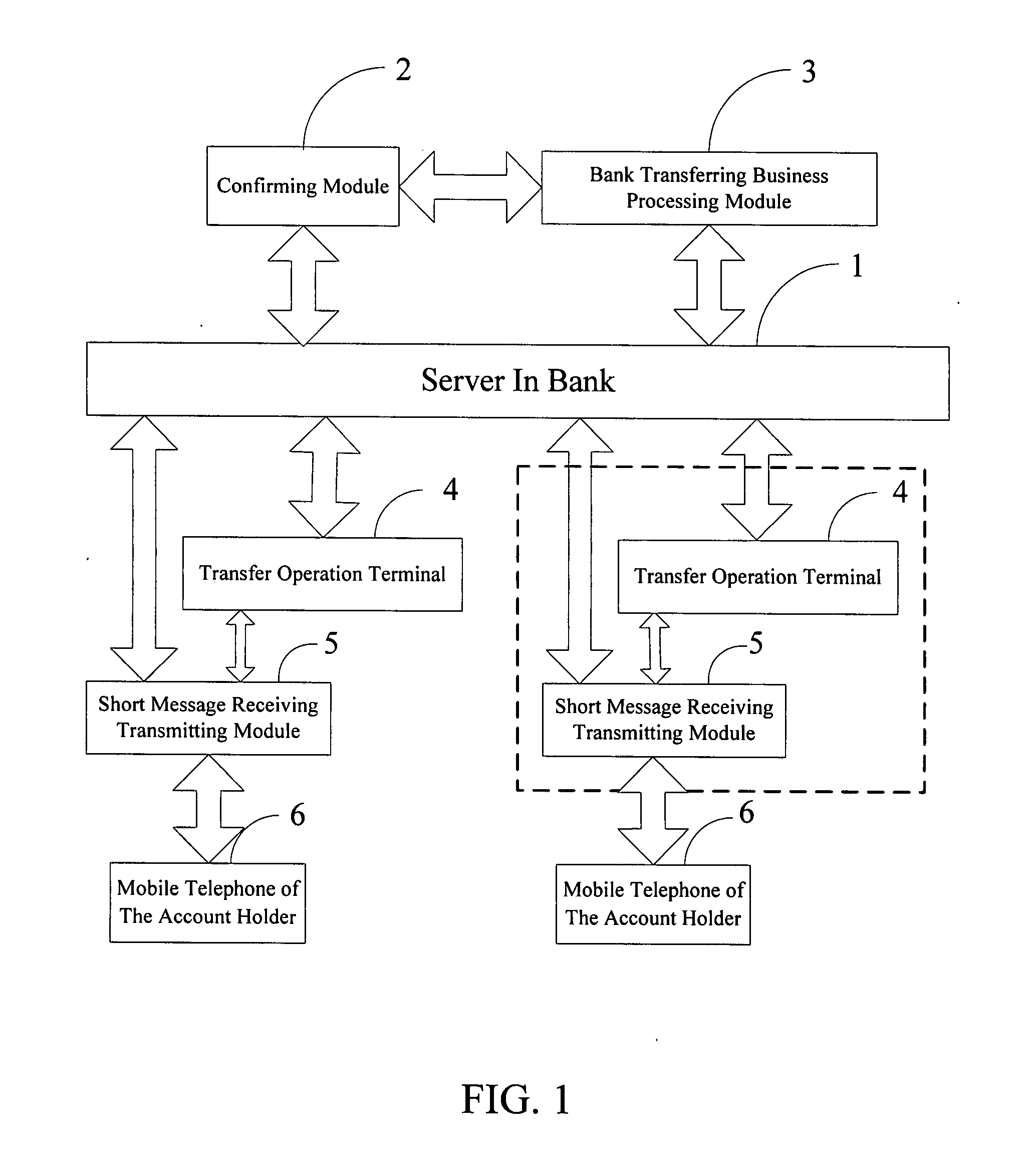

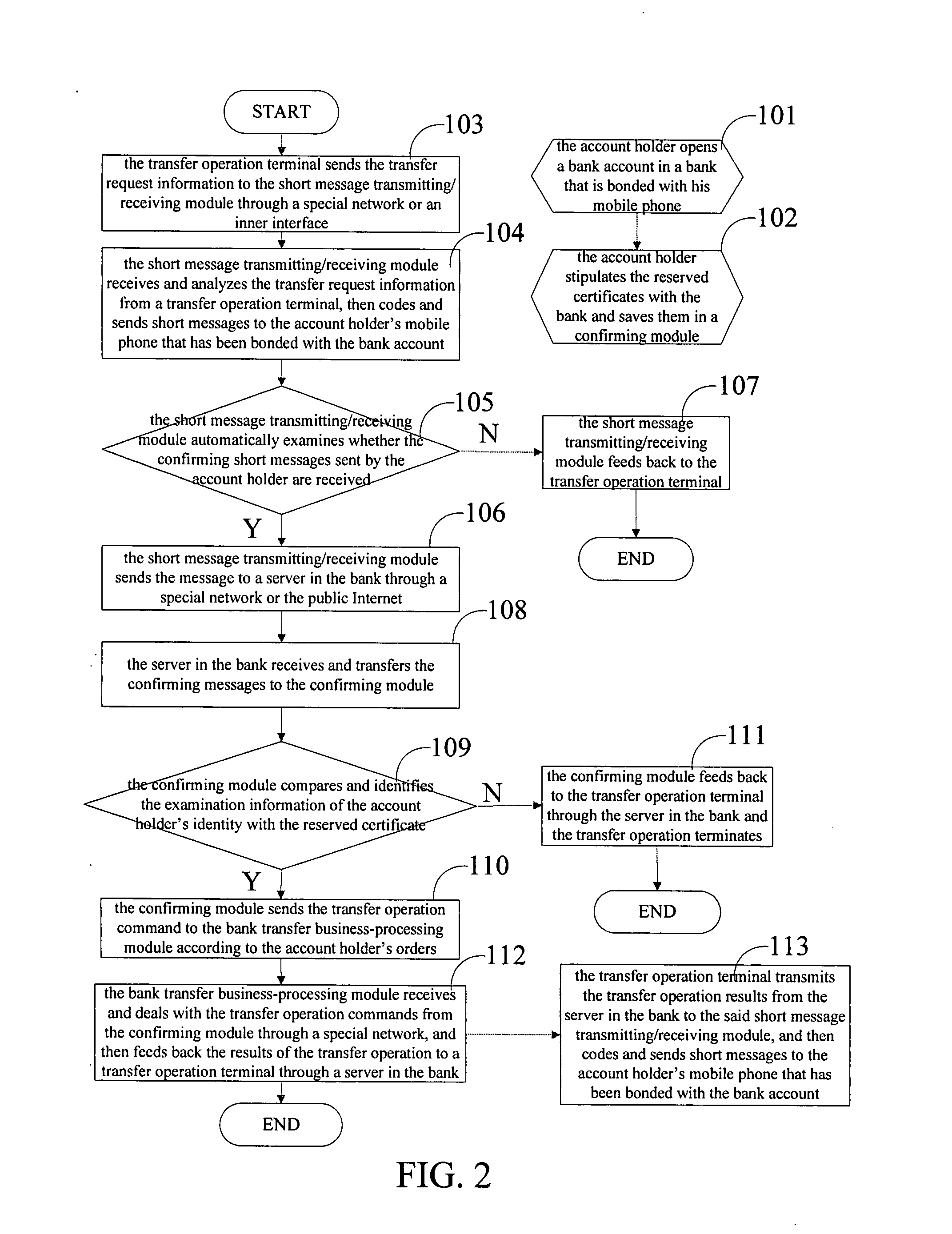

System That Realizes Fund Transfer by Mobile Telephone Short Message Confirming Mode and Method Thereof

InactiveUS20070244813A1Reduce riskSafety is assuredComplete banking machinesFinancePasswordBank account

The present invention relates to a system which implements bank transactions and records the method thereof, and provides a system that realizes transfer of funds by mobile telephone with a short message confirming mode and method thereof. The system of the present invention comprises a server in a bank, a confirming module, a bank transfer business-processing module, a transfer operation terminal, and a short message transmitting / receiving module. The method of the present invention includes a short message transmitting / receiving module that informs the account holder of the transferring request in a short message before the bank account fund changes, and then forwards the confirmation message to the confirming module which identifies the account holders according to a reserved certificate. It then receives the account holder's fund-allocating command, and starts the bank transfer business processing module to perform the fund-allocating operation. The present invention enables account holders to have real-time control over the changing status of the funds in their bank accounts and to efficiently avoid the risk of the account holders' account funds being randomly allocated. Furthermore, it protects the account holder from unauthorized withdrawals if the account holder loses his credit card, his passbook or debit card, or has his note password or signature stolen.

Owner:ZHOU XING

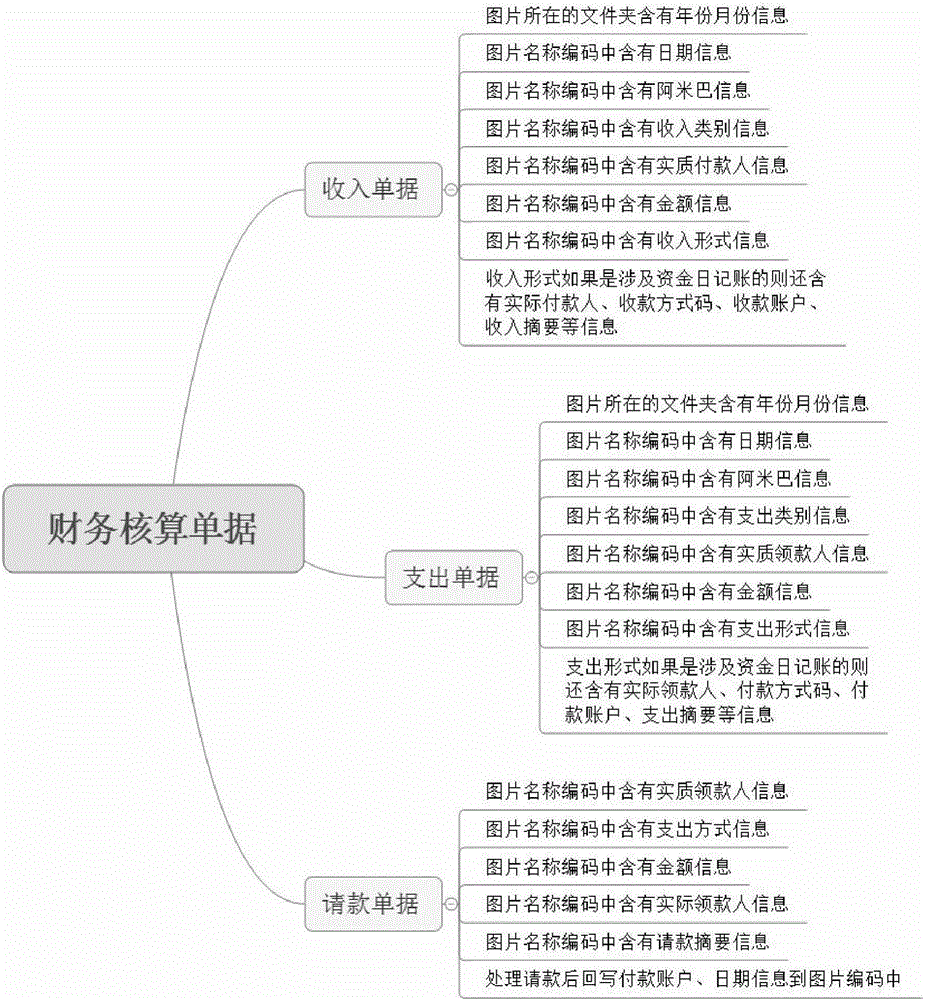

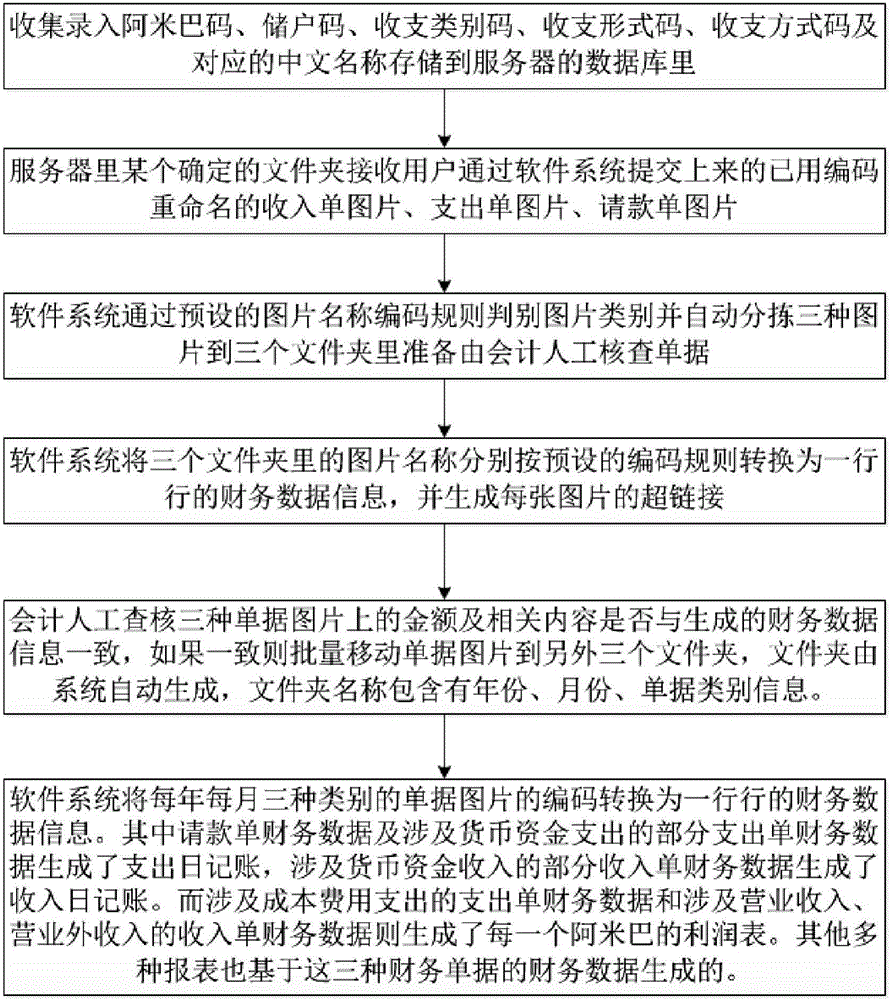

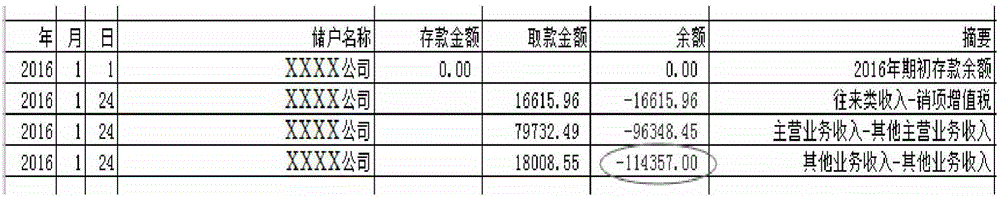

Financial data processing method applied to ameba management depositing and withdrawing style

InactiveCN105825425AImprove data securityStrong flexibility and applicabilityFinanceHyperlinkFinancial data processing

The invention relates to a financial data processing method applied to an ameba management depositing and withdrawing style. Facts that an enterprise and a depositor provide labor, goods and funds for a bank are regarded as depositing behaviors; facts that the bank provides labor, goods and funds for the depositor are regarded as withdrawing behaviors; employees serve as depositor representatives, a financial document of each depositor generates a document electronic image file, is converted into a code and uploaded to a server as the name of the file, a line of data information which is corresponding to a hyperlink of the electronic image file is generated by the code name; the financial data information generates an income and expense journal; and a preset profit table generation system acquires and summarizes the financial data information to generate a profit table, and the system generates a reconciliation statement in a bank book flow format for each depositor. According to the method of the invention, the depositing and withdrawing money and the original document electronic image file for each depositor can be checked, and the management cash inflow condition, the profit accounted according to an accrual basis and the profit accounted according to a cash basis are accounted for each ameba.

Owner:朱树柏

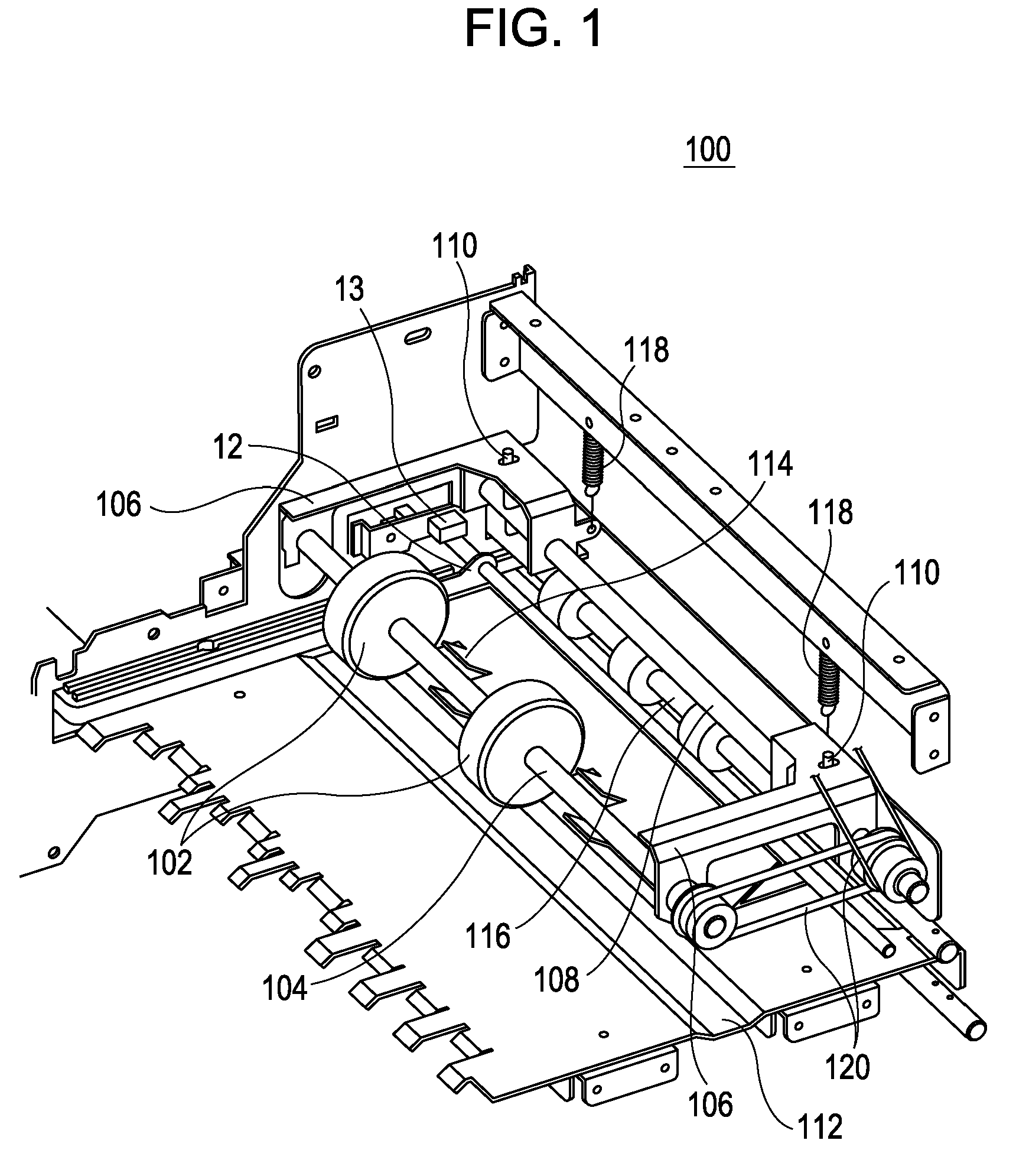

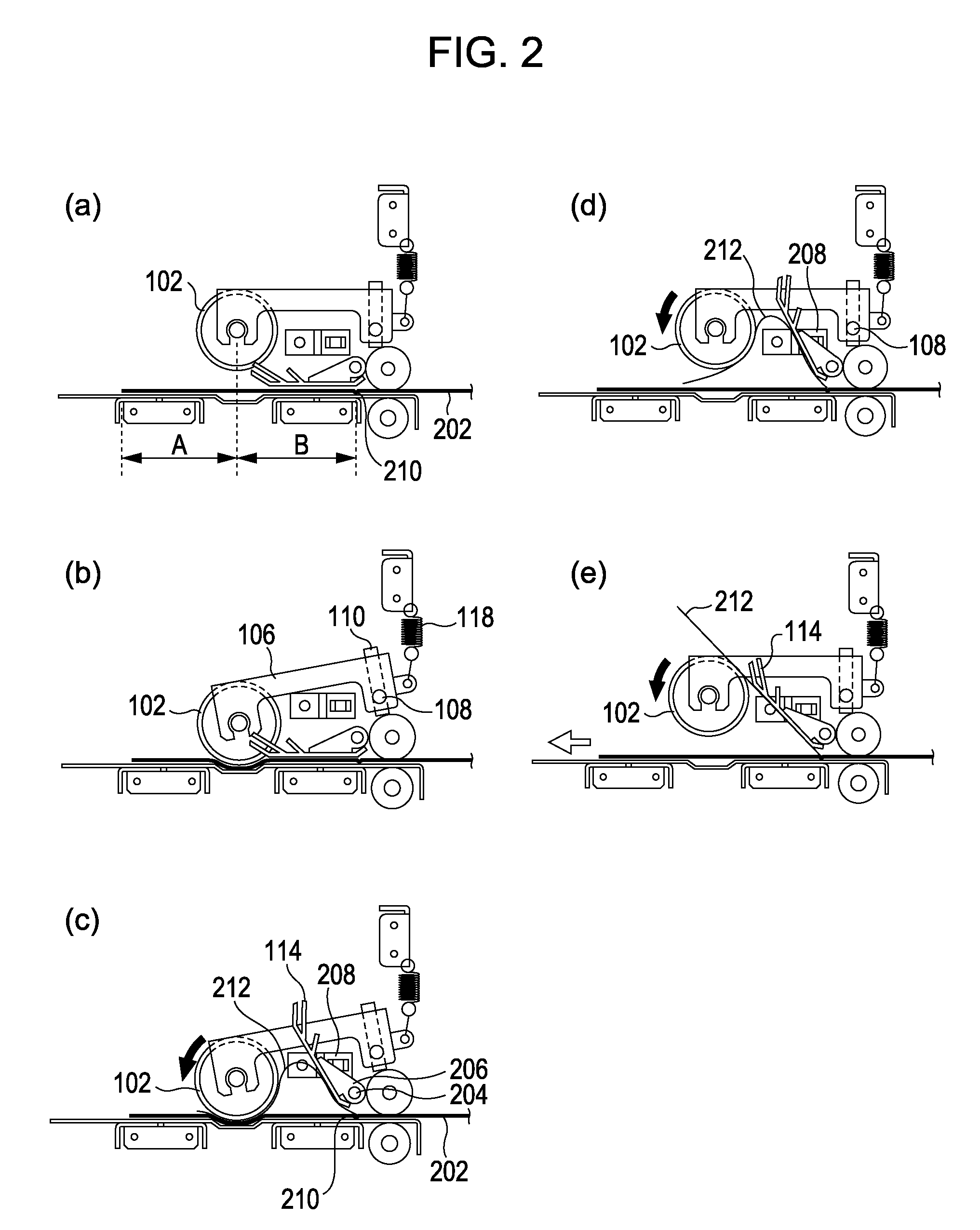

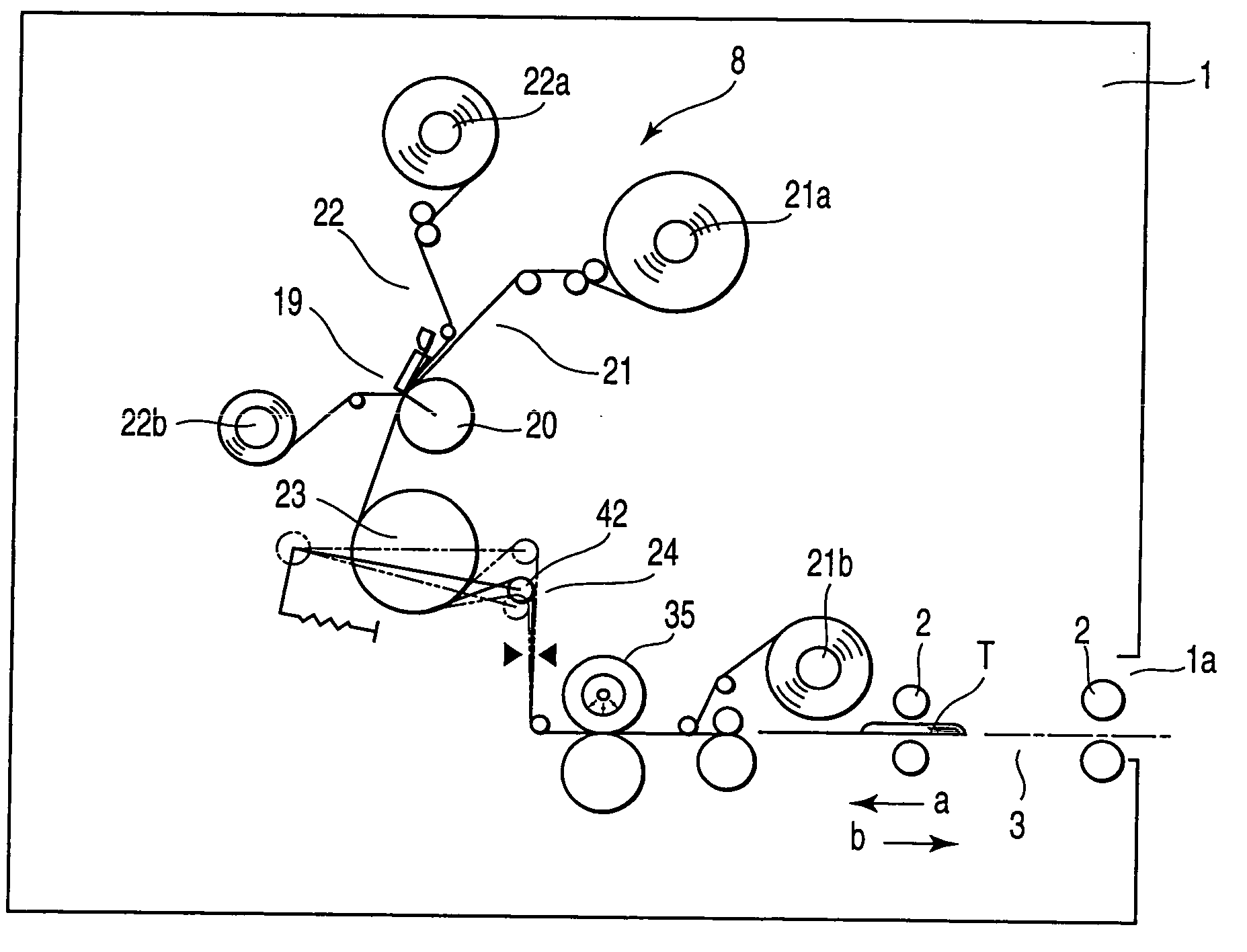

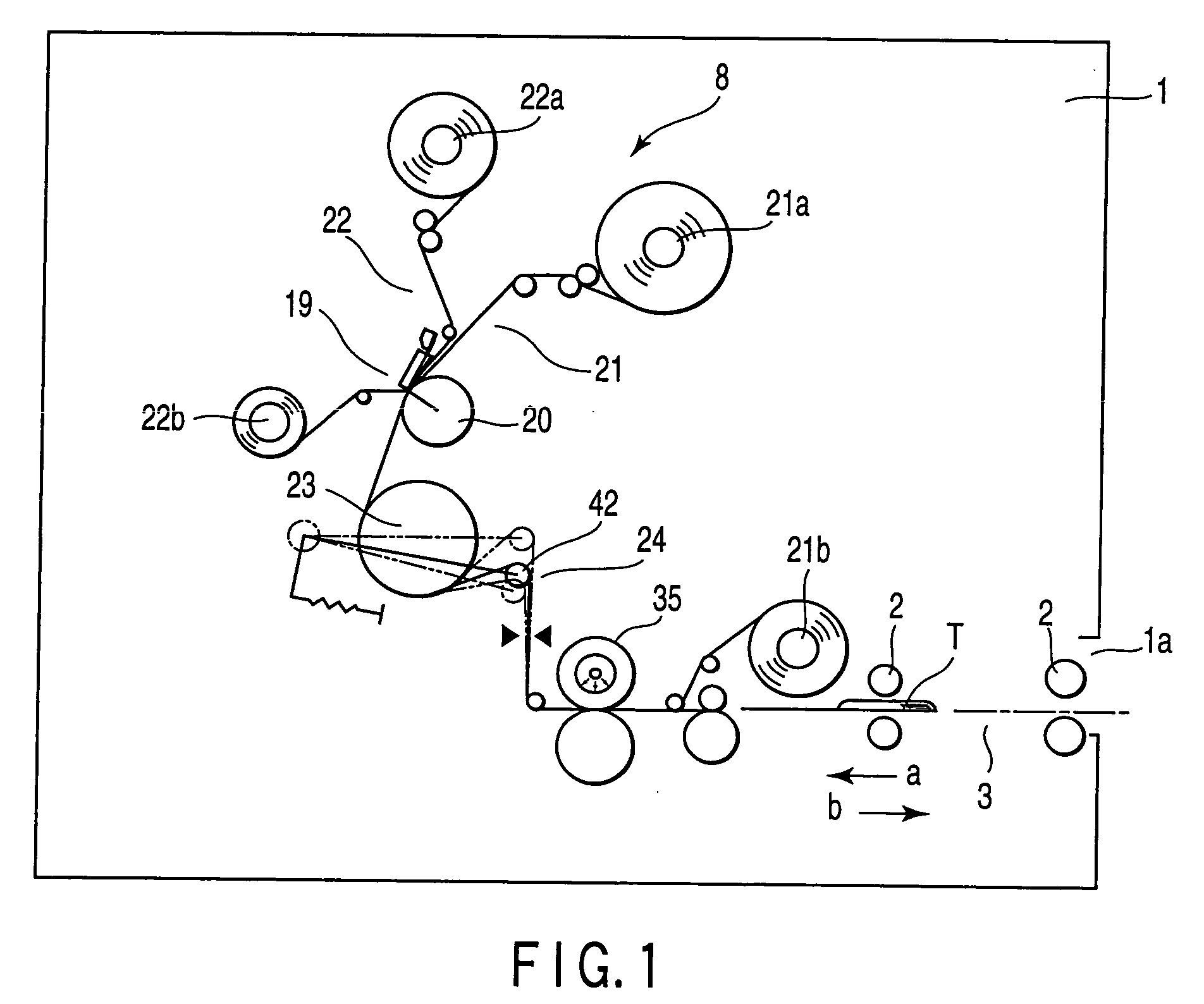

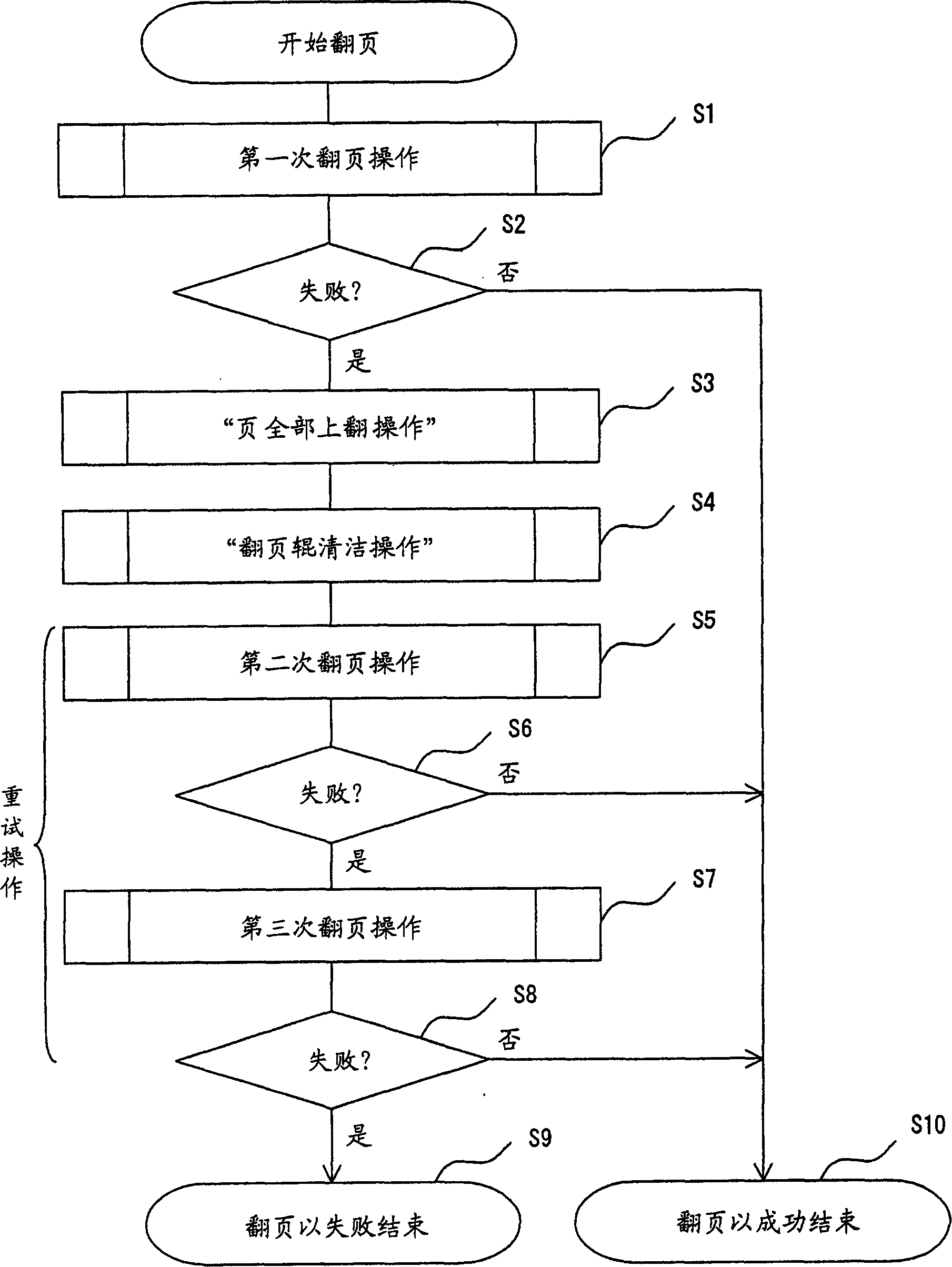

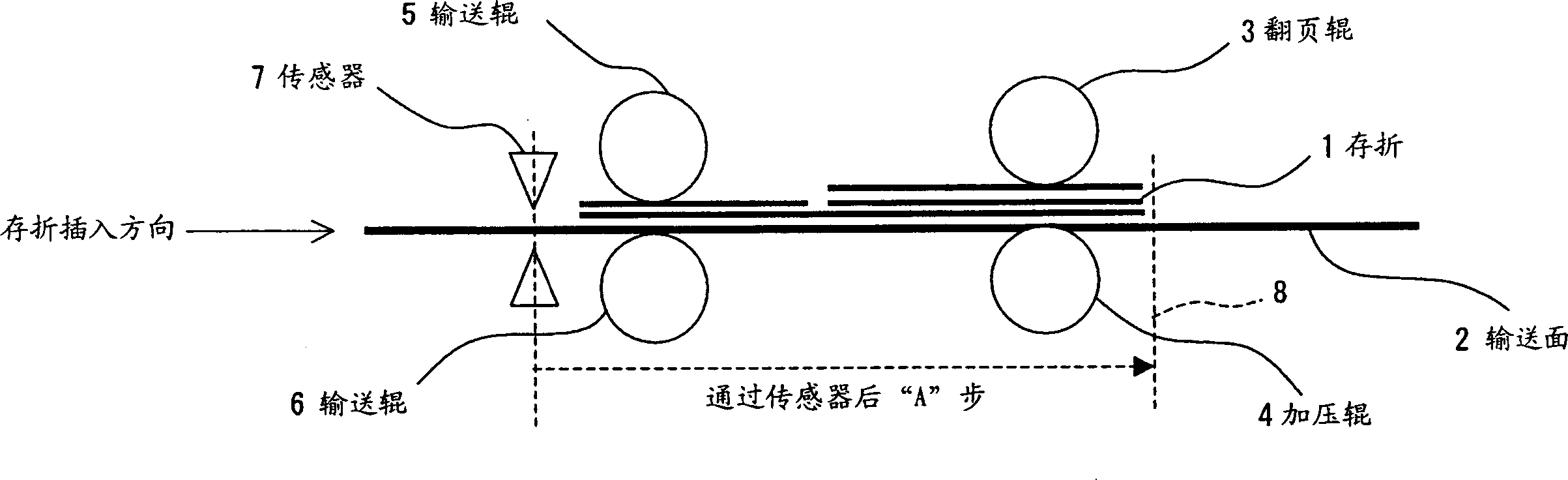

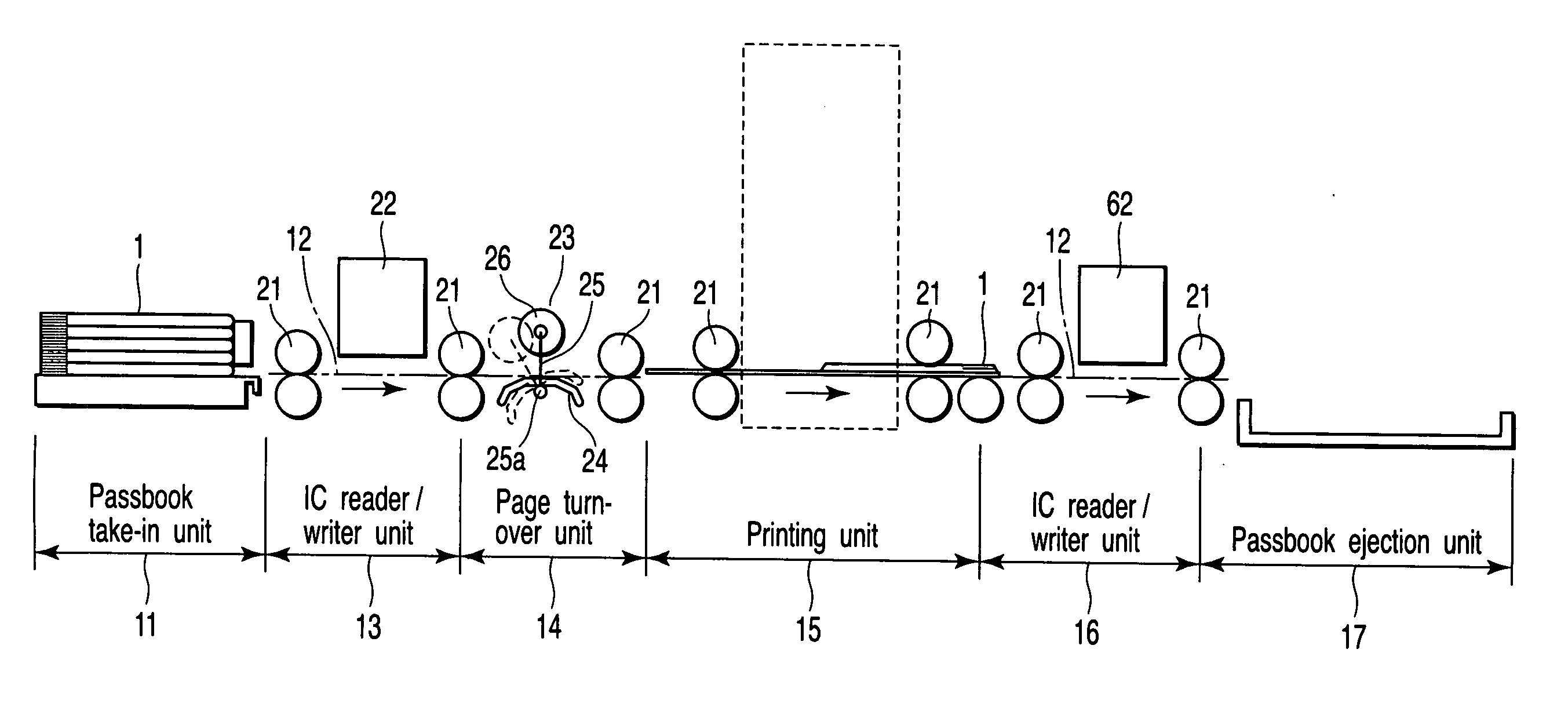

Apparatus, method, and control program for turning the pages of a passbook

InactiveUS20080157456A1Avoid mistakesComplete banking machinesInking apparatusPassbookComputer science

A page turning apparatus of a passbook printer, which detects a turning error or the like at the early stage of turning irrespective of the size and characteristics of passbooks and allows retry of turning in a short time. The apparatus includes: a passbook conveying path; a detecting device placed on the conveying path; storing means that stores a passbook holding position and a threshold value corresponding to a determined size; a page turning mechanism configured to buckle the paper of an turning target page and to turn the buckled paper at the passbook holding position; a buckling sensor that senses a buckling status; a conveying mechanism that can convey the passbook to a designated position on the conveying path; and control means configured to drive the conveying mechanism so that the passbook is conveyed to the passbook holding position, and drive the page turning mechanism to buckle the paper, wherein the control means, if the buckling status sensed by the buckling sensor indicates that the buckling extent does not reach over the threshold value within a predetermined time, determines that the buckling has failed and drives the conveying mechanism so that the passbook is conveyed from the passbook holding position to a revised position apart therefrom by a predetermined adjusting distance.

Owner:IBM CORP

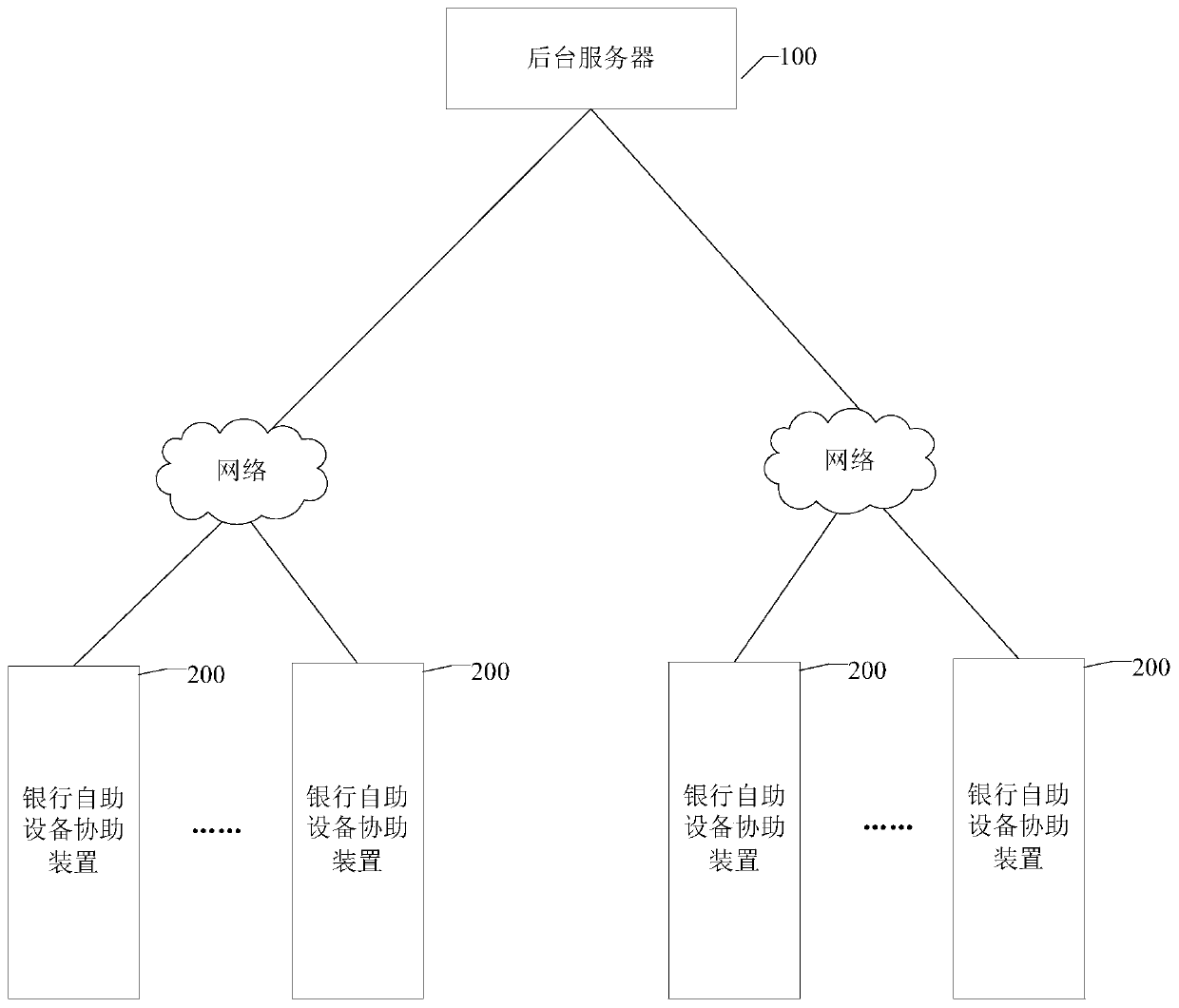

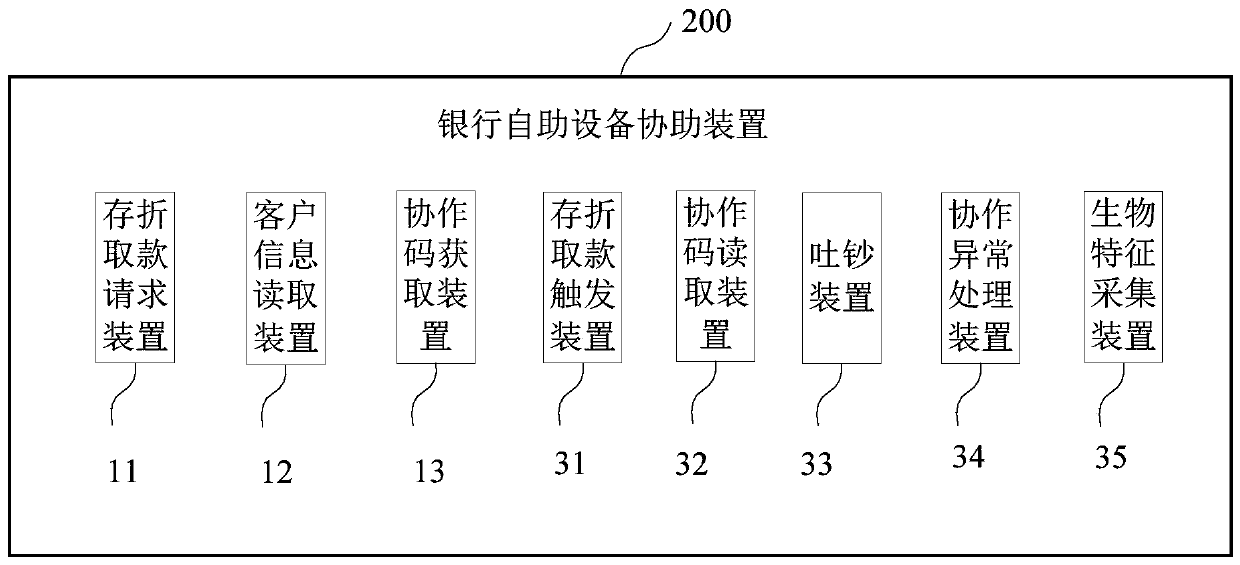

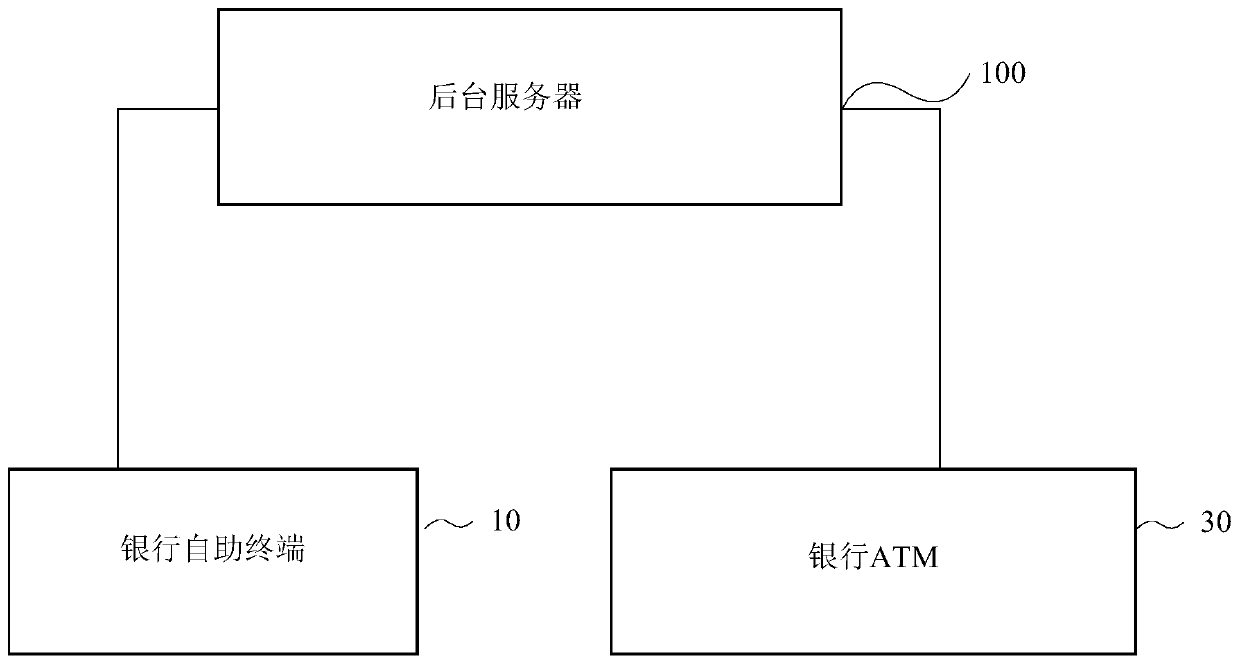

Bank self-service equipment assisting device, bank self-service cooperation system and method

ActiveCN110060433AAlleviate the business pressure of passenger flowComplete banking machinesATM softwaresPasswordPassbook

The invention provides a bank self-service cooperation method, a bank self-service equipment assisting device, a bank self-service cooperation system, computer equipment and a computer readable storage medium, and relates to the technical field of financial equipment. The method comprises the following steps that the bank self-service equipment assisting device receives a withdrawal request sent by a client through a passbook and reads client information; a background server generates a cooperation code and effective time of the cooperation code according to the client information; the bank self-service equipment assisting device receives an cooperation code, acquires the withdrawal information input by the client according to the cooperation code, and sends the cooperation code and the withdrawal information to the background server; the background server verifies the cooperation code and the passbook password, and outputs a bill spitting instruction when the verification is successful; and the bank self-service equipment assisting device is used for discharging the bank note according to a bank note discharging instruction. The bank self-service cooperation method, the bank self-service equipment assisting device, the bank self-service cooperation system, the computer equipment and the computer readable storage medium solve the problem that the passbook client cannot withdrawcash from the ATM in the bank outlets at present, and can relieve the pressure of the counter passenger flow business without extra hardware investment of a bank enterprise.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

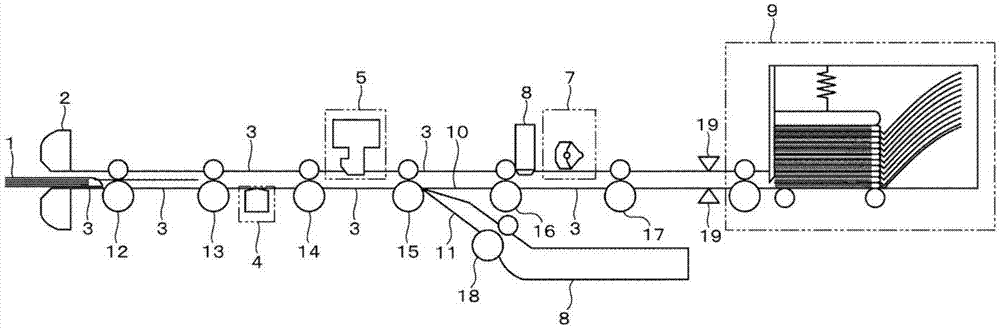

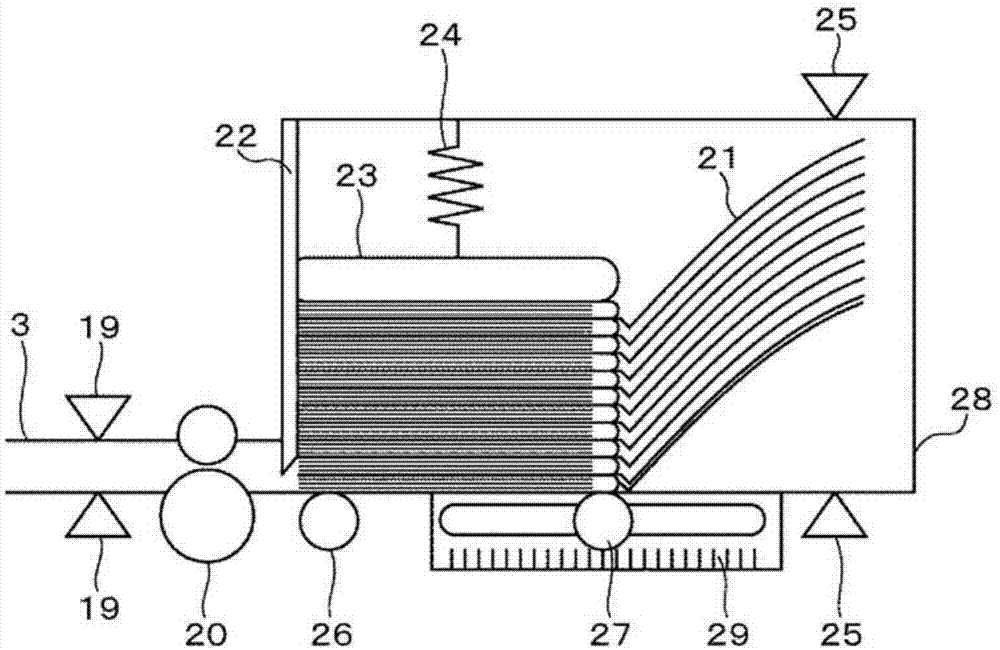

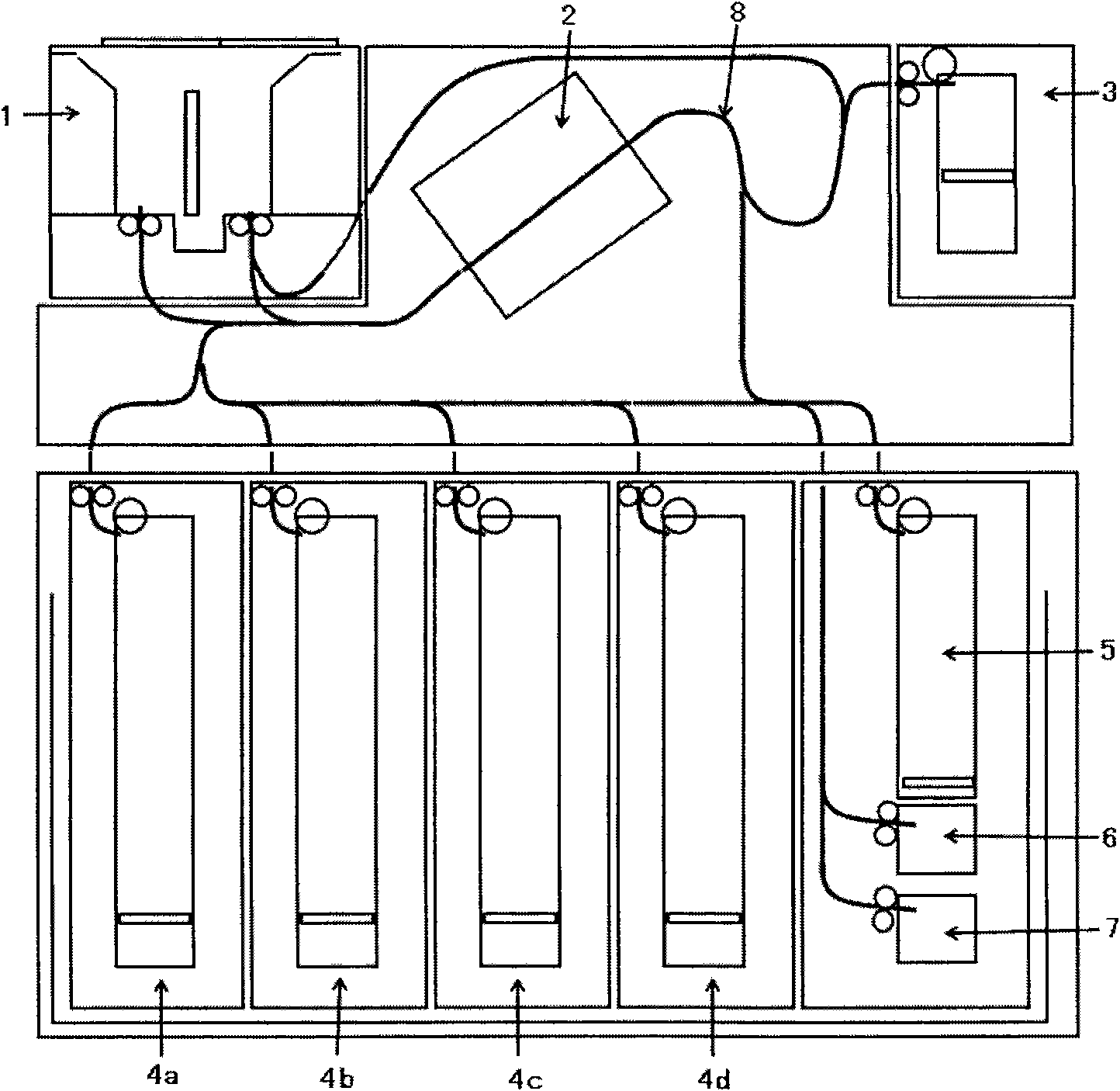

Bankbook issuing mechanism

Provided is a bankbook issuing mechanism that issues bankbooks by feeding the bankbooks one by one from a feed opening of a storage unit that stores the bankbooks in a state where a back-bulge part is facing towards the rear and the pages are opened, and the mechanism is provided with the following: a first roller that is disposed near the feed opening; a second roller disposed near the back-bulge part of the bankbooks which are stored in the storage unit; a pressing-force unit for imparting a pressing force to the bankbooks; and a control unit for rotating a first pickup roller and a second pickup roller, and feeding the bankbooks which were subjected to a pressing force by the pressing-force unit out from the feed opening one by one.

Owner:HITACHI OMRON TERMINAL SOLUTIONS CORP

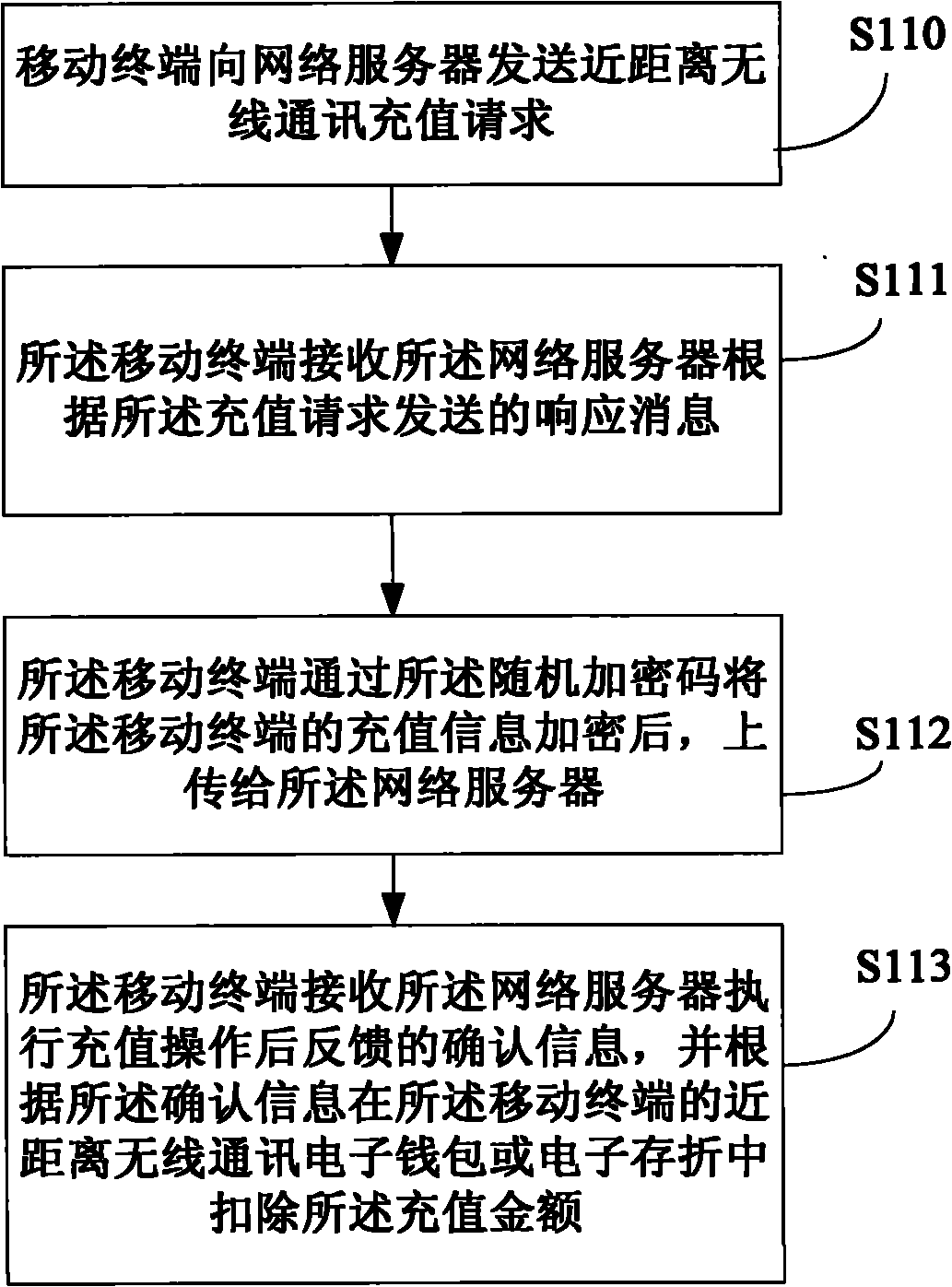

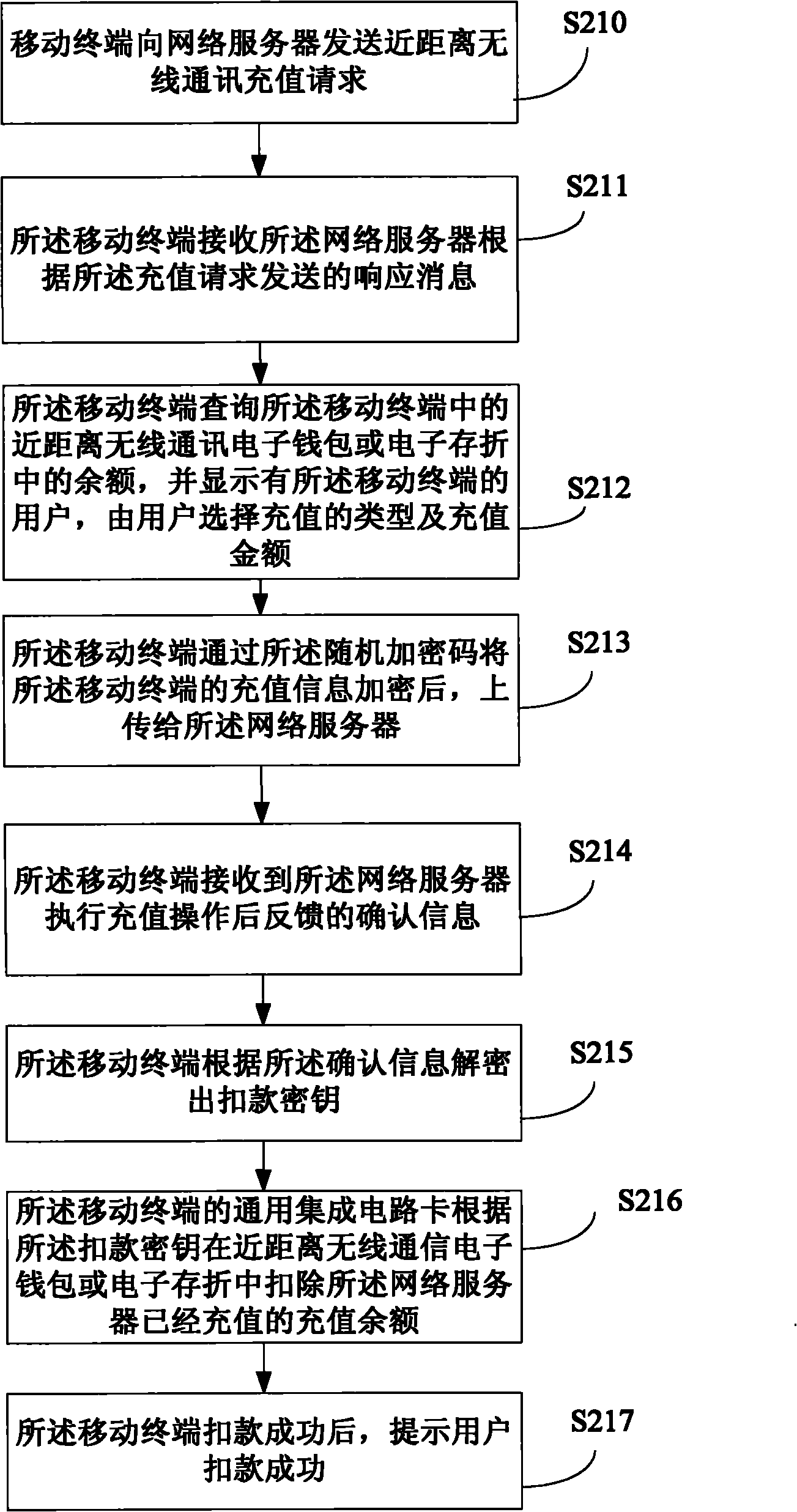

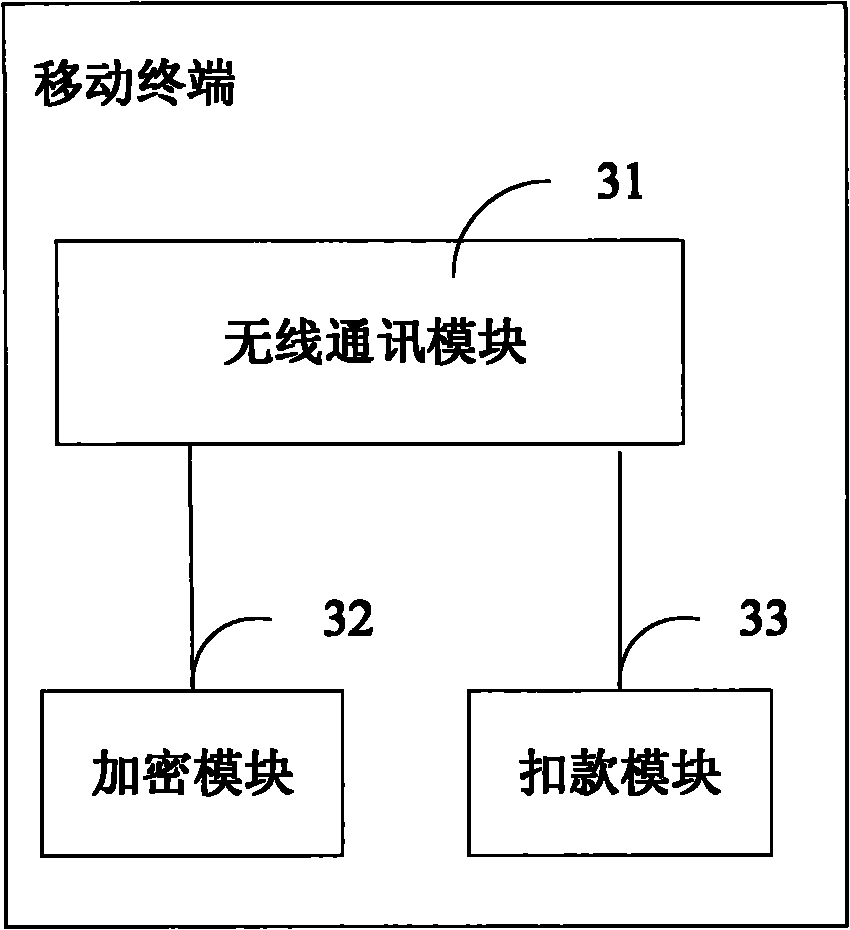

Method for recharging mobile terminal, mobile terminal and server

InactiveCN101895652ARealize direct debit recharge functionImprove experiencePrepayment telephone systemsPassbookNetwork service

The embodiment of invention provides a method for recharging a mobile terminal, the mobile terminal and a server. The method comprises the following steps that: the mobile terminal transmits a near field communication recharging request to a network server; the mobile terminal receives response information transmitted by the network server according to the recharging request; after encrypting the recharging information of the mobile terminal through a random encryption code, the mobile terminal uploads the recharging information to the network server; and the mobile terminal receives confirm information fed back by the network server after recharging operation is performed and deducts a recharging amount from a near field communication electronic purse or electronic passbook of the mobile terminal according to the confirm information. Through the implementation of the embodiment of the invention, recharging can be realized by directly deducting on the mobile terminal, so that a user does not need to recharge with a rechargeable card or go to a business hall for recharging.

Owner:YULONG COMPUTER TELECOMM SCI (SHENZHEN) CO LTD

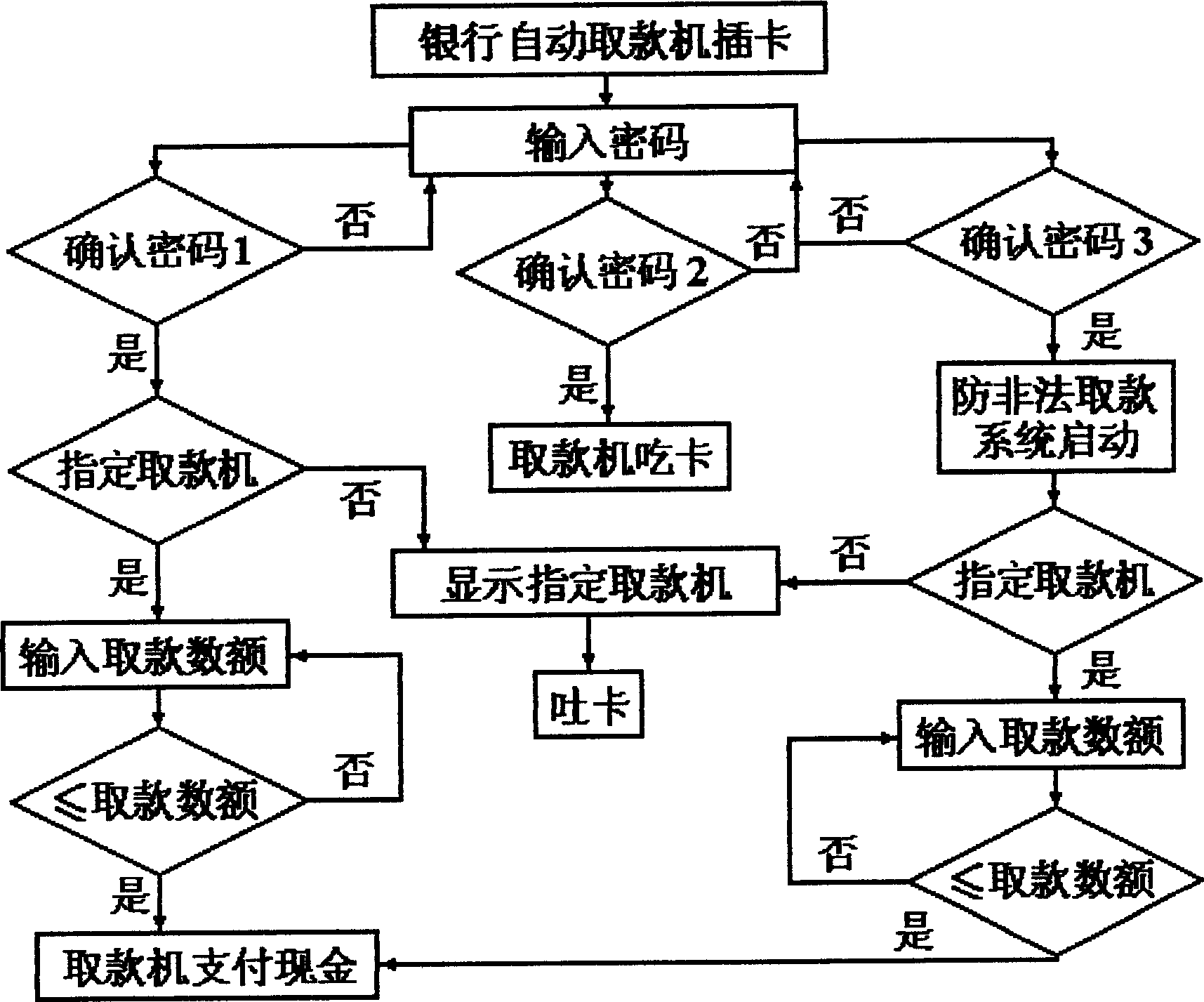

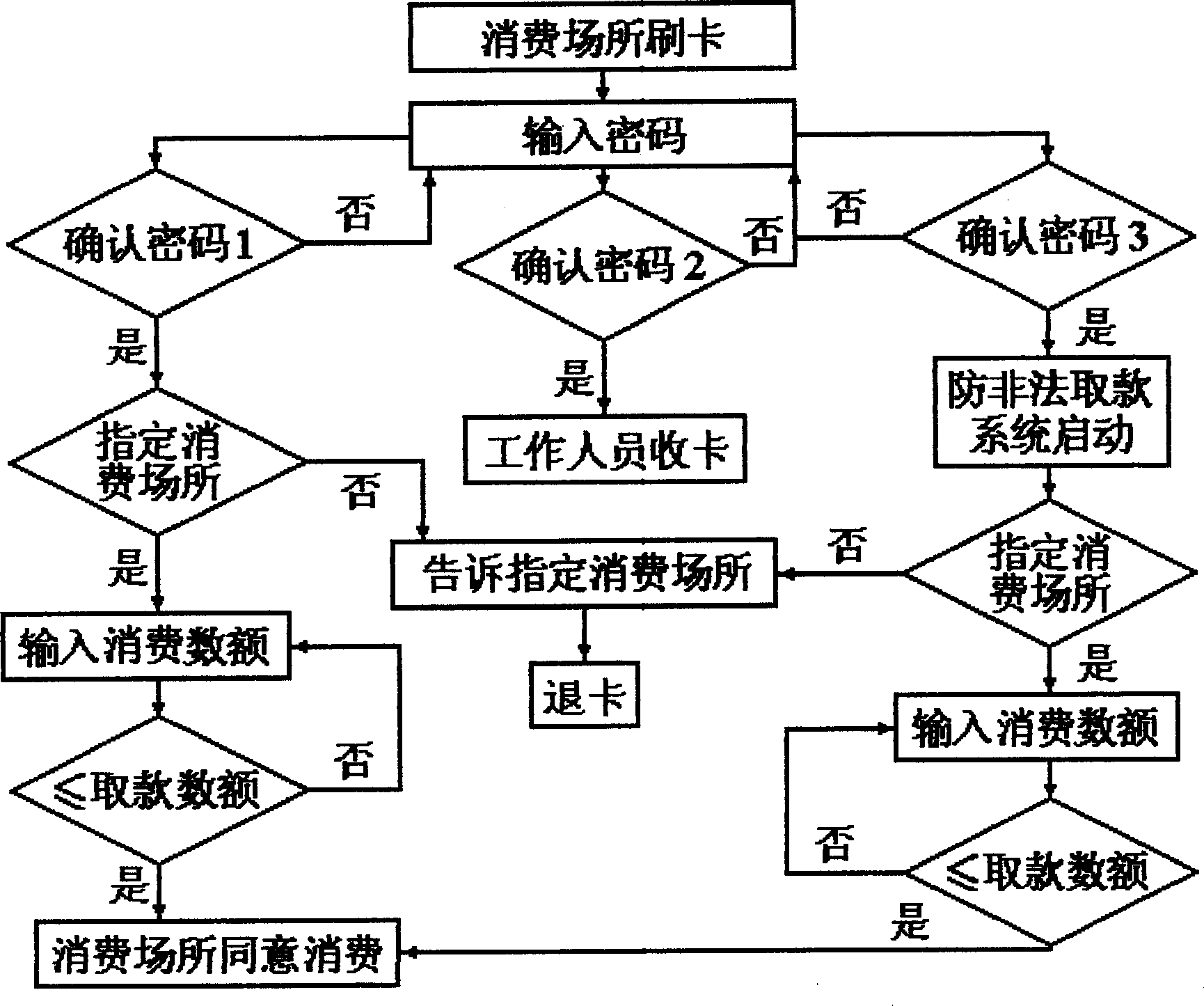

Safety and embezzle proofing method of credit card, financial card and savings card

InactiveCN1595461AImprove securityReduce the use effectComplete banking machinesCoded identity card or credit card actuationCredit cardPassword

The invention relates to an insurant anti-theft method suitable for the credit card, the finance card and the stock card. It is composed of the automatic teller machine computer management system and the computer management system of the ATMs in the bank. The characteristic is that at least two entering passwords allowed by the ATM computer management system are stored in the computer management system of the ATMs in the bank, which are the normal password and the illegal draw money password. But when the consumer draws money with the illegal password, the ATM computer management system starts the security system, which informs the securities of the bank and the department of public security. The concealed computer-assisted makeup locks the consumer and follows his activities. The ATM slows its operating speed and pays money according to the appointed amount to the consumer.

Owner:WUHAN UNIV

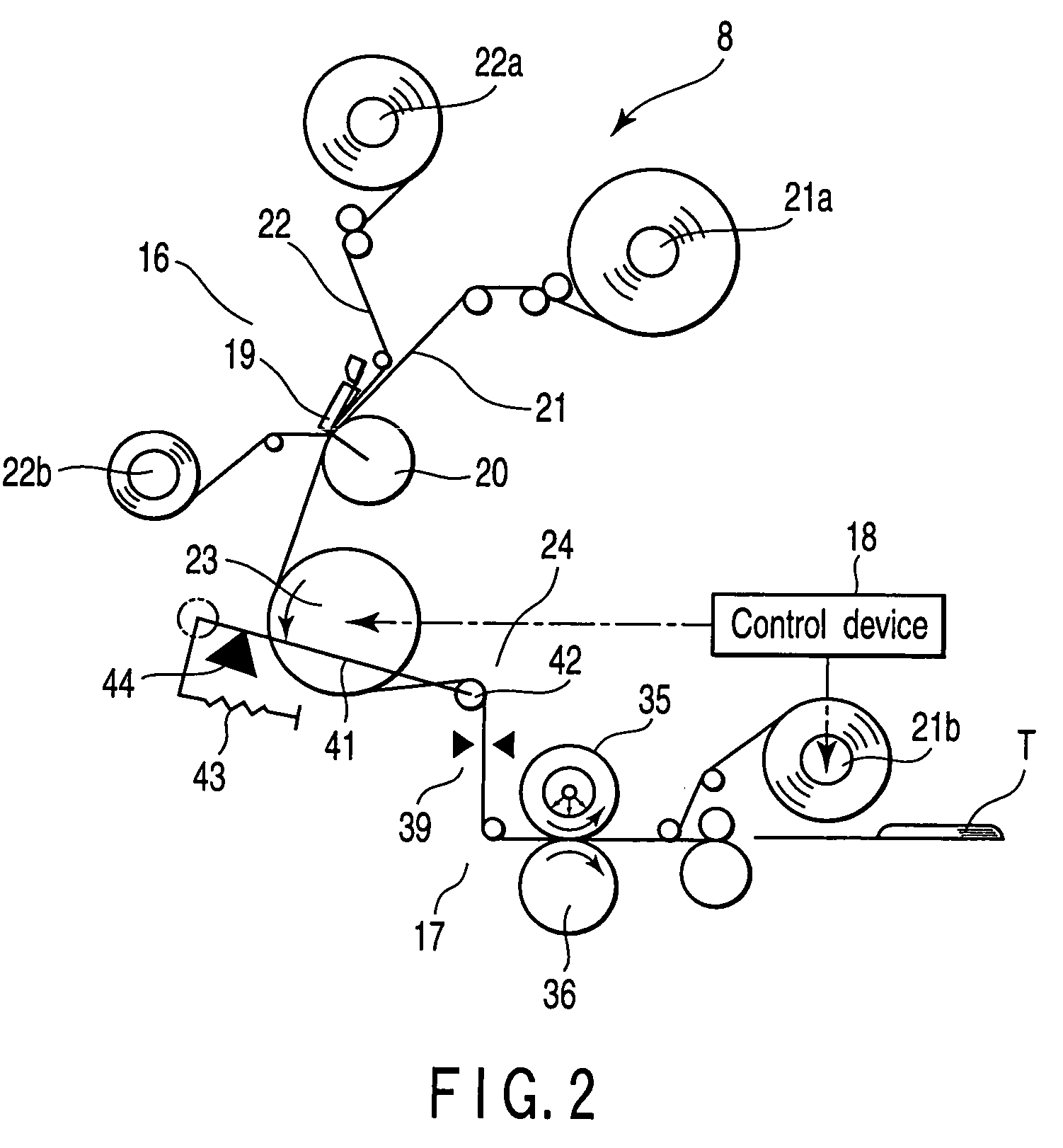

Printing apparatus and method for passbooks

A passbook printing apparatus comprises a movable tension roller correcting slack of an intermediate transfer film resulting from a different in a feed speed between a film drive roller and a film wind-up reel, and a control device operating the film wind-up reel to apply a predetermined tension to the intermediate transfer material in a state of stopping the film drive roller, thereby moving and fixing the tension roller to a predetermined position, and thereafter, feeding the intermediate transfer film by a predetermined distance by the film drive roller to position it to the transfer position.

Owner:KK TOSHIBA

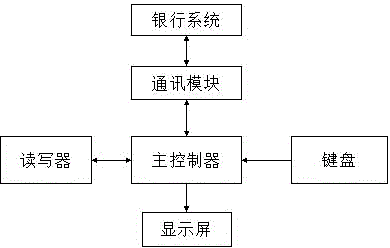

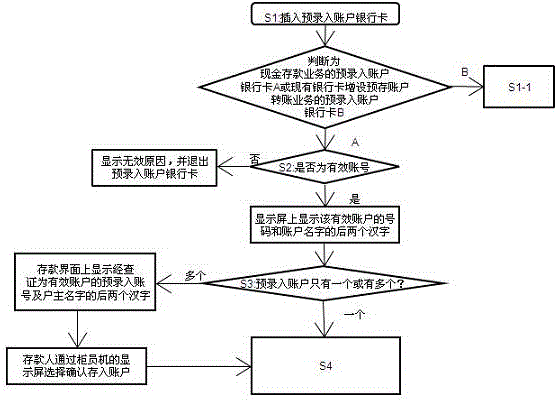

Pre-input account bank card, information input device and using methods thereof

ActiveCN104392561AImprove work efficiencyAlleviate queuingComplete banking machinesDeposit accountPassbook

The invention provides a pre-input account bank card, an information input device, a using method of the pre-input account bank card and a using method of the information input device. The pre-input account bank card can have the cash deposit service or can be formed in a mode that the pre-deposit account transfer service is additionally set on the basis of an existing bank card, deposit account information is input into the pre-input account bank card through the information input device, and therefore the convenient and rapid deposit service can be achieved, when all deposit or transfer services are conducted through a teller machine, people do not need to manually input the account number with nineteen figures, and the time consumed by card-free and passbook-free deposit operation is greatly shortened; meanwhile, the probability of errors in operation of users is reduced, the phenomenon of queuing in front of the teller machine is relieved, working efficiency of banks is improved, and new service income is generated for the banks; the pre-input account bank card also provides a new paperless payment mode for payment work of schools, administrative units, revenue departments, enterprises and public institutions, adapts to development of the fast-paced society and is environmentally friendly and reliable.

Owner:北京中电汇智科技有限公司

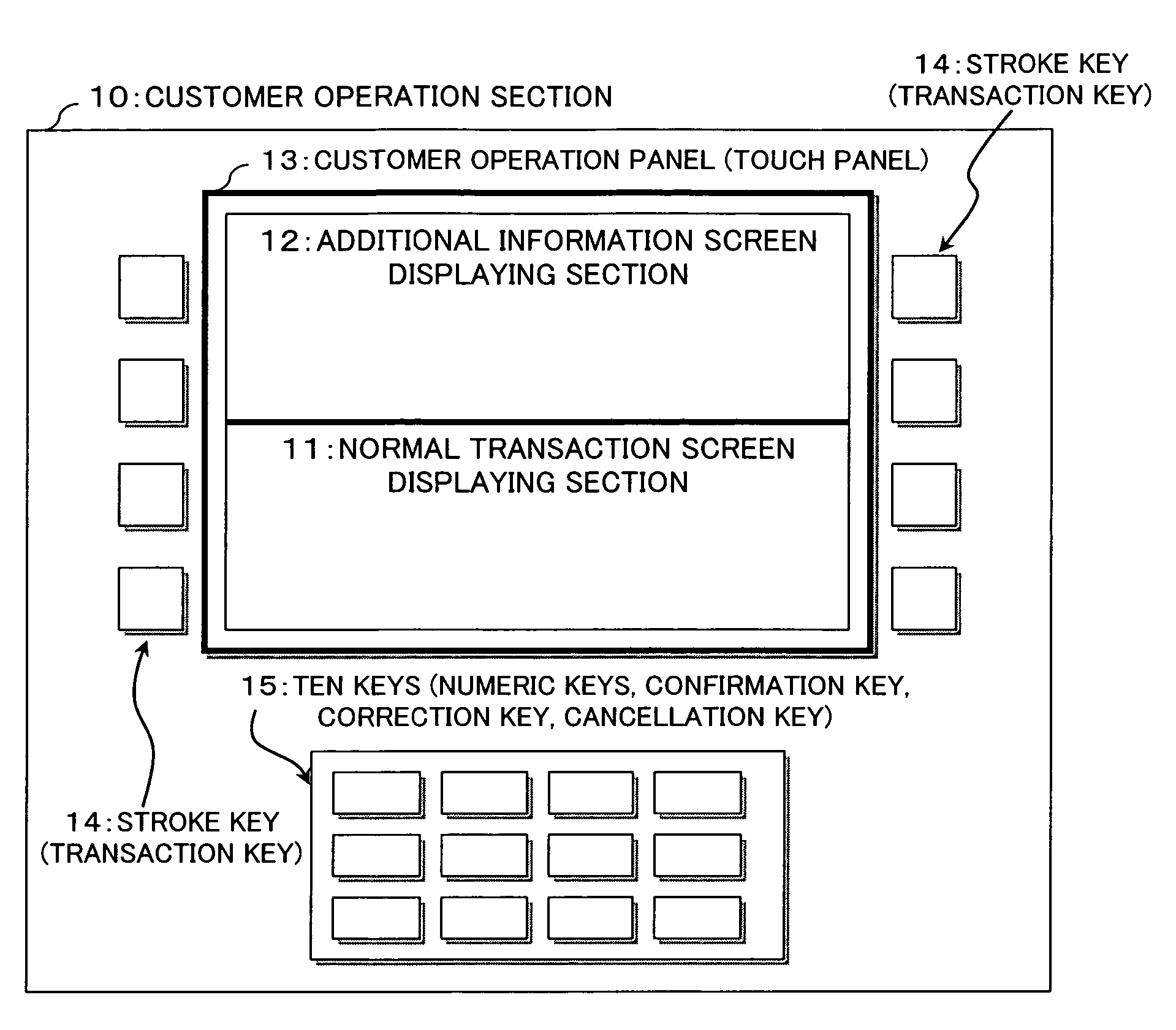

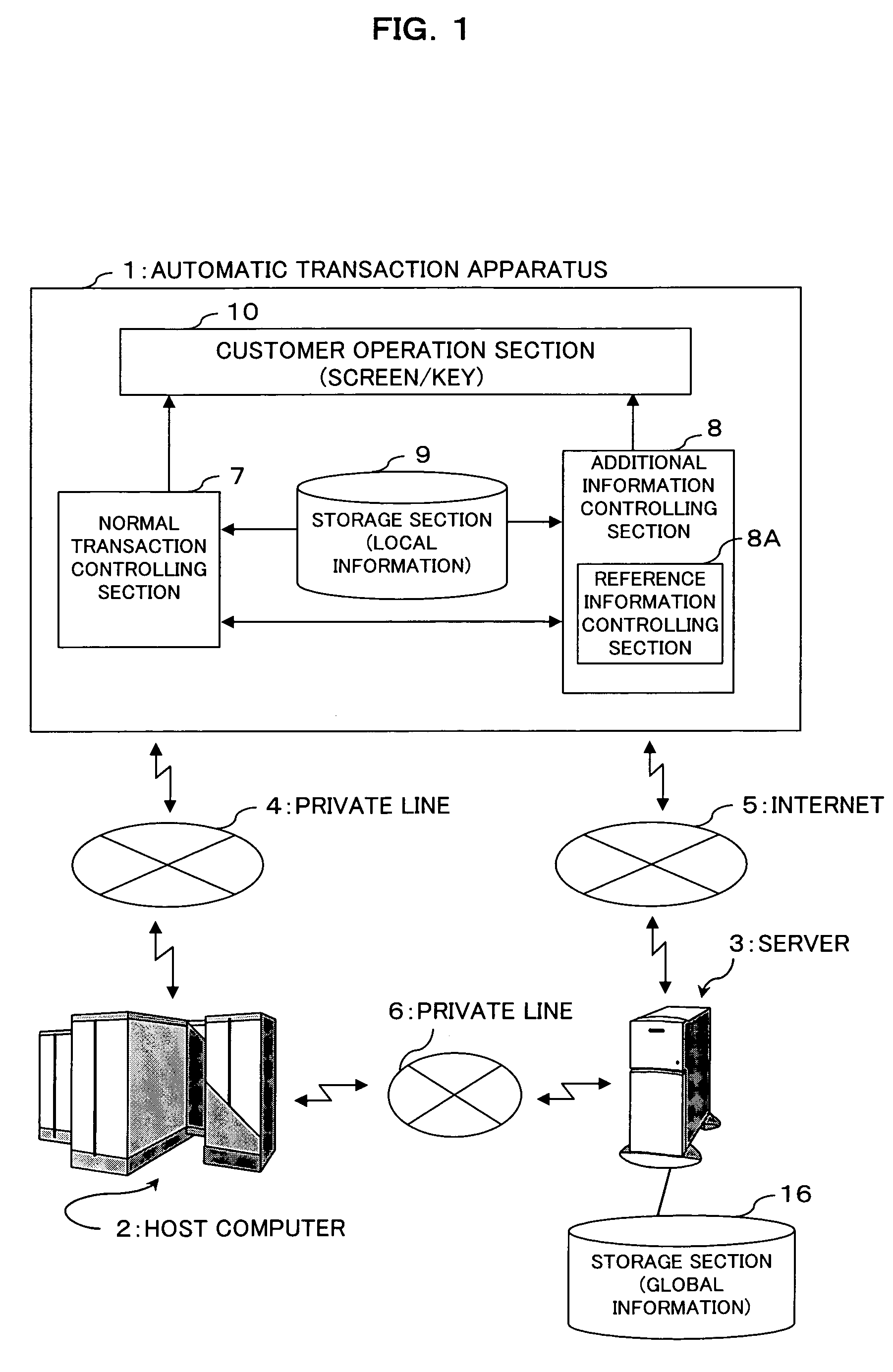

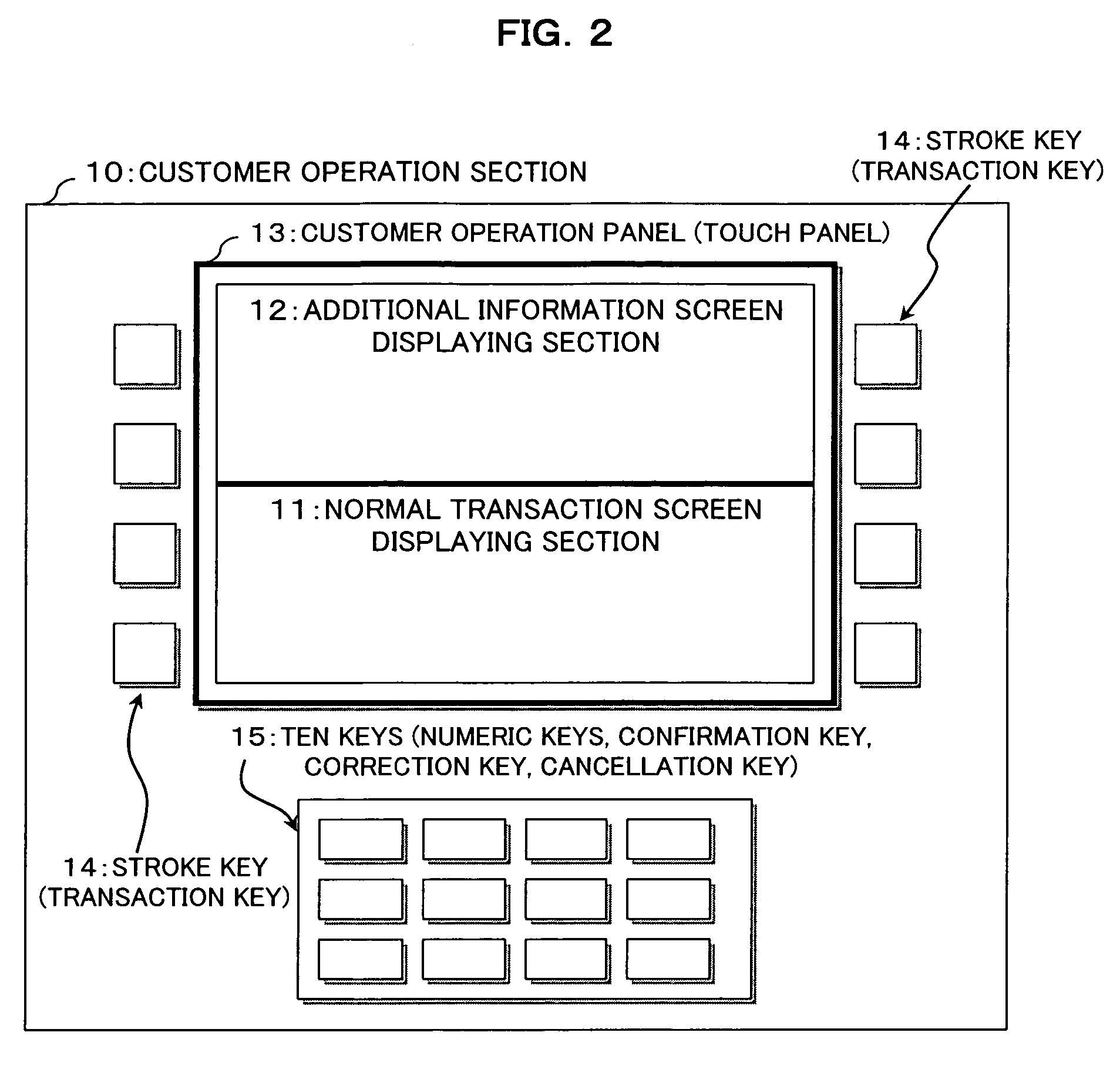

Automatic transaction apparatus

When a transaction such as, for example, a balance inquiry, a cash transaction such as money deposition or money withdrawal, a transfer, a passbook entry, or an inquiry for details of used money amounts or an available money amount is to be performed, additional information at a suitable point of time to improve the operability, reduce the time required for a transaction, and achieve an effective and accurate transaction, an automatic transaction apparatus is provided The apparatus includes a transaction screen displaying section, an additional information screen displaying section, and a control section.

Owner:FUJITSU LTD

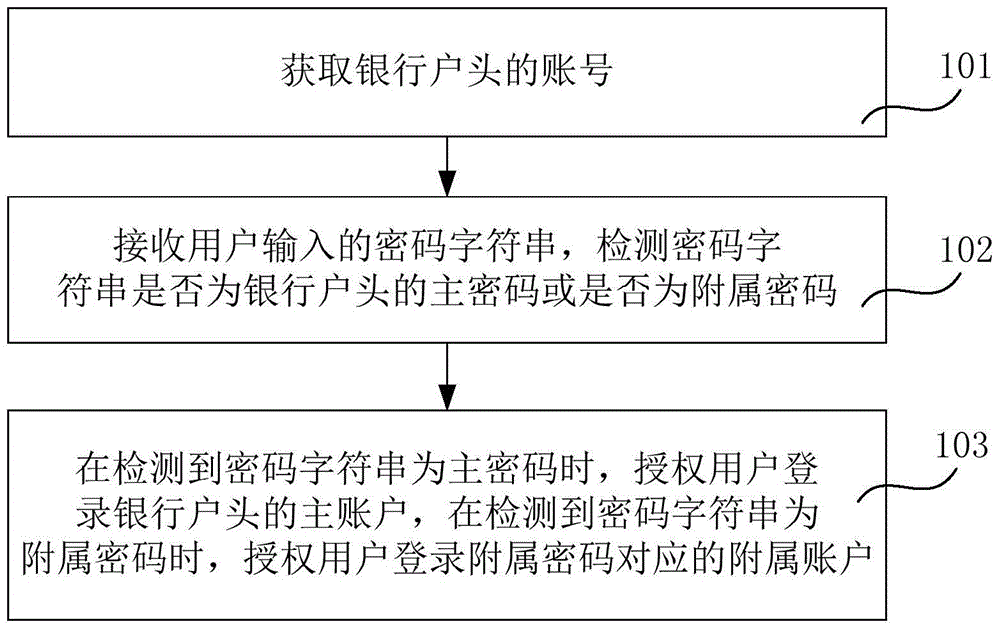

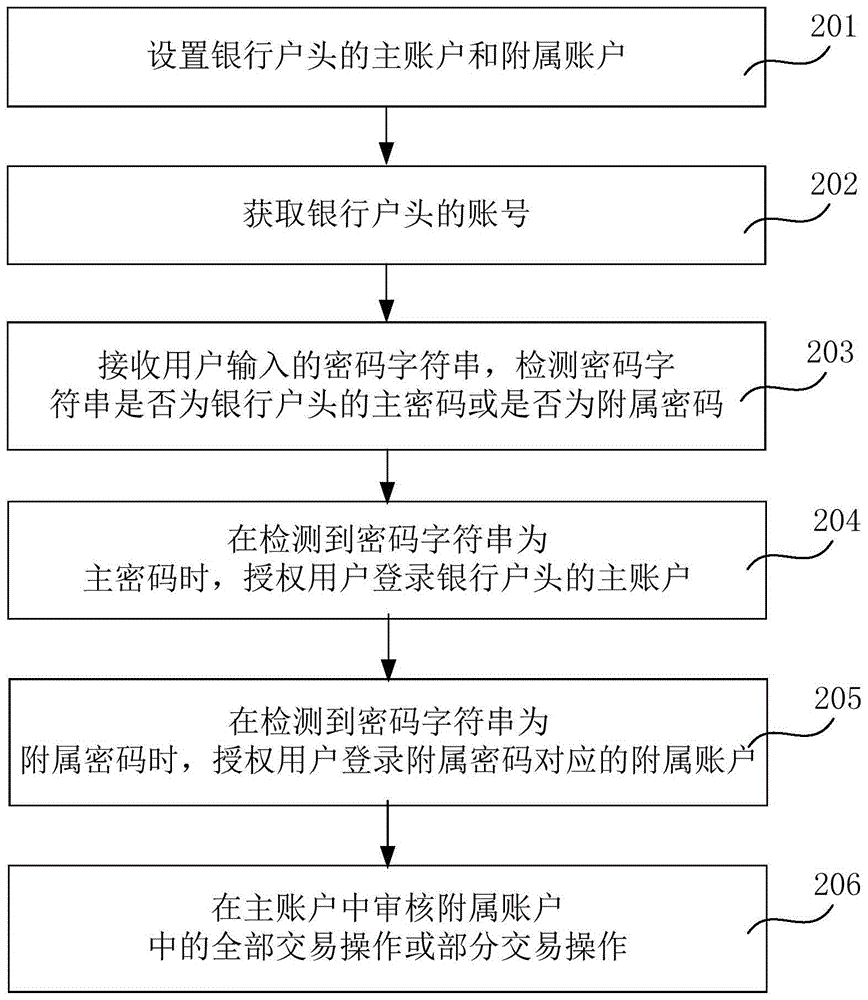

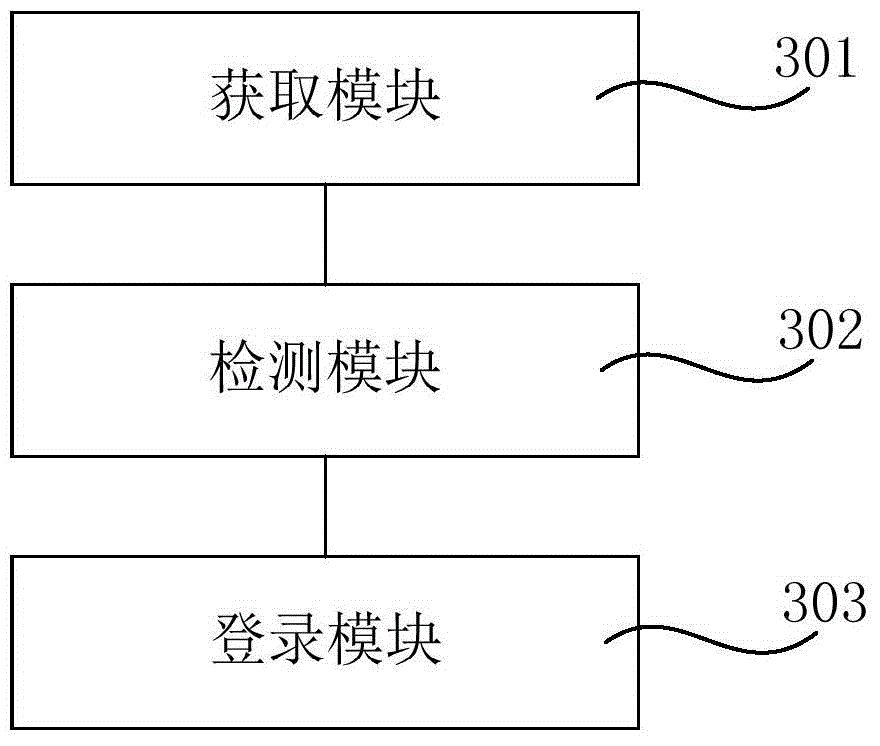

Bank account management method and device

InactiveCN104463672AImprove user experienceAvoid red tapeFinanceDigital data authenticationApproaches of managementBank account

The invention provides a bank account management method and device. The bank account management method includes the steps that the account number of a bank account is obtained, and the bank account comprises a main account body and more than one adjunct account body; a password character string input by a user is received, whether the password character string is a main password or an auxiliary password of the bank account is detected; if the password character string is the main password, the user gets authorization to log in the main account body of the bank account, and if the password character string is the auxiliary password, the user gets authorization to log in the adjunct account body corresponding to the auxiliary password. According to the bank account management method, multiple users can share one bank account, the different users enter the main account and the adjunct accounts of the bank account respectively by inputting the different passwords, the users can manage the account used by many persons conveniently, the cost and handling charge for handling multiple bank cards and bank books are saved, the tedious procedures caused by management on bank accounts and passwords of the multiple bank accounts are avoided, and use experience of the users is improved.

Owner:黄熙镜

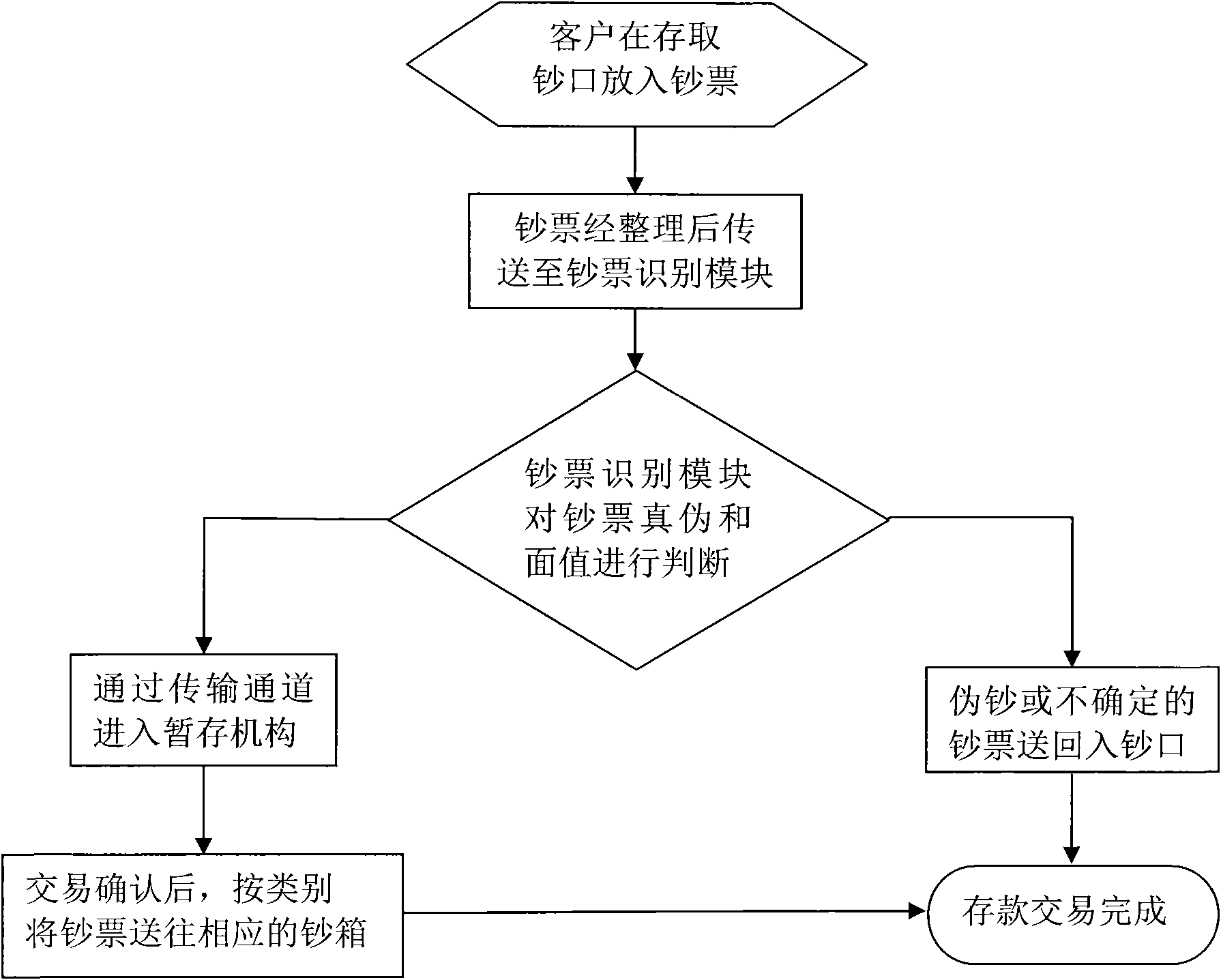

Money number recognition method for money detection module

InactiveCN101964123AAvoid imageAvoid lostPaper-money testing devicesCoin/currency accepting devicesPassbookPayment card number

The invention discloses a money number recognition method for a money detection module. In the method, the truth or falseness and face value of money can be judged and the serial number of each money paper in a transaction can be recorded in a deposit and withdraw transaction process, so that a corresponding bank card number or deposit book account number can be inquired through the serial number of the money paper once fake money is found at the end of the transaction, a corresponding client is traced and loss is recovered. By the method, the guarantee of banks and depositors is increased, effective bases are provided for a fake money transaction, the problems of the depositors and the banks are solved and the image and compensation losses of banks are avoided at the same time.

Owner:SHENZHEN YIHUA COMP

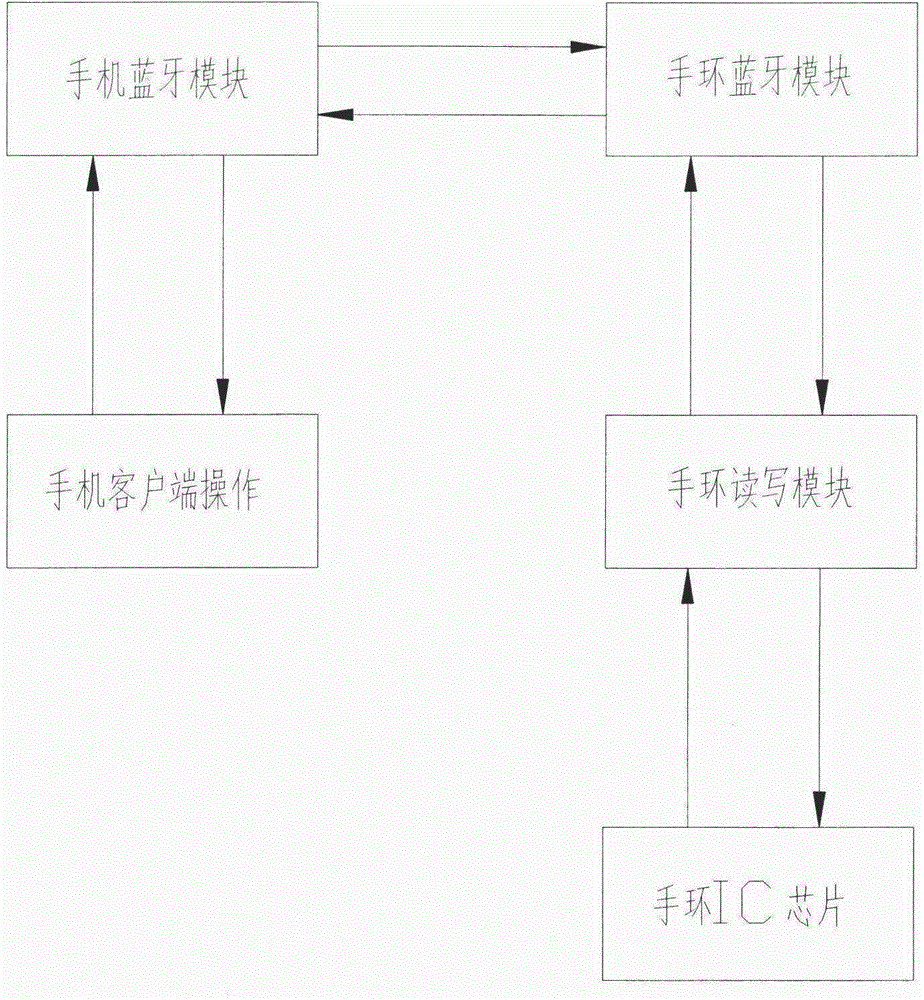

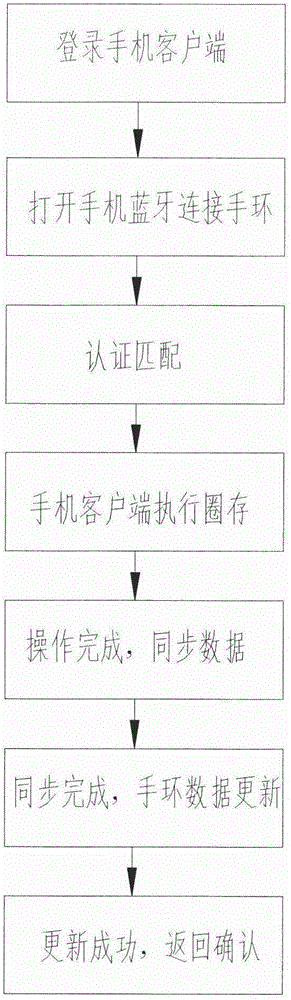

Bluetooth bracelet and Bluetooth communication method thereof

InactiveCN105357377AIndependent and convenient loading and rechargingIndependent and convenient balance inquiryPayment architectureSubstation equipmentPassbookData memory

The invention provides a Bluetooth bracelet. The Bluetooth bracelet comprises a bracelet body, wherein the inside of the bracelet body is integrally provided with a bracelet IC (Integrated Circuit) card module, a bracelet Bluetooth module, a bracelet read-write module and a bracelet security control module; the bracelet IC card module comprises an existing bracelet IC card radio-frequency circuit, a bracelet IC chip and a bracelet data memory; a Bluetooth communication method of the Bluetooth bracelet comprises the following steps: generating a random PIN (Personal Identification Number) code when an external connection request exists; inputting a PIN code in matching authentication with the bracelet Bluetooth module by a user at a mobile phone client; establishing a matched connection between the Bluetooth bracelet and a mobile phone; after receiving a signal of the bracelet Bluetooth module by the bracelet read-write module, performing read-modify write on the bracelet IC chip according to an instruction, and after read-modify write, returning data to the bracelet Bluetooth module; returning a confirmation message to the mobile phone by the bracelet Bluetooth module and then the communication is finished. The Bluetooth technology realizes the purpose of directly reading the IC chip by skipping a card reader, and an electronic wallet or a passbook amount in the bracelet can be recharged online.

Owner:SUZHOU CITIZEN CARD CO LTD

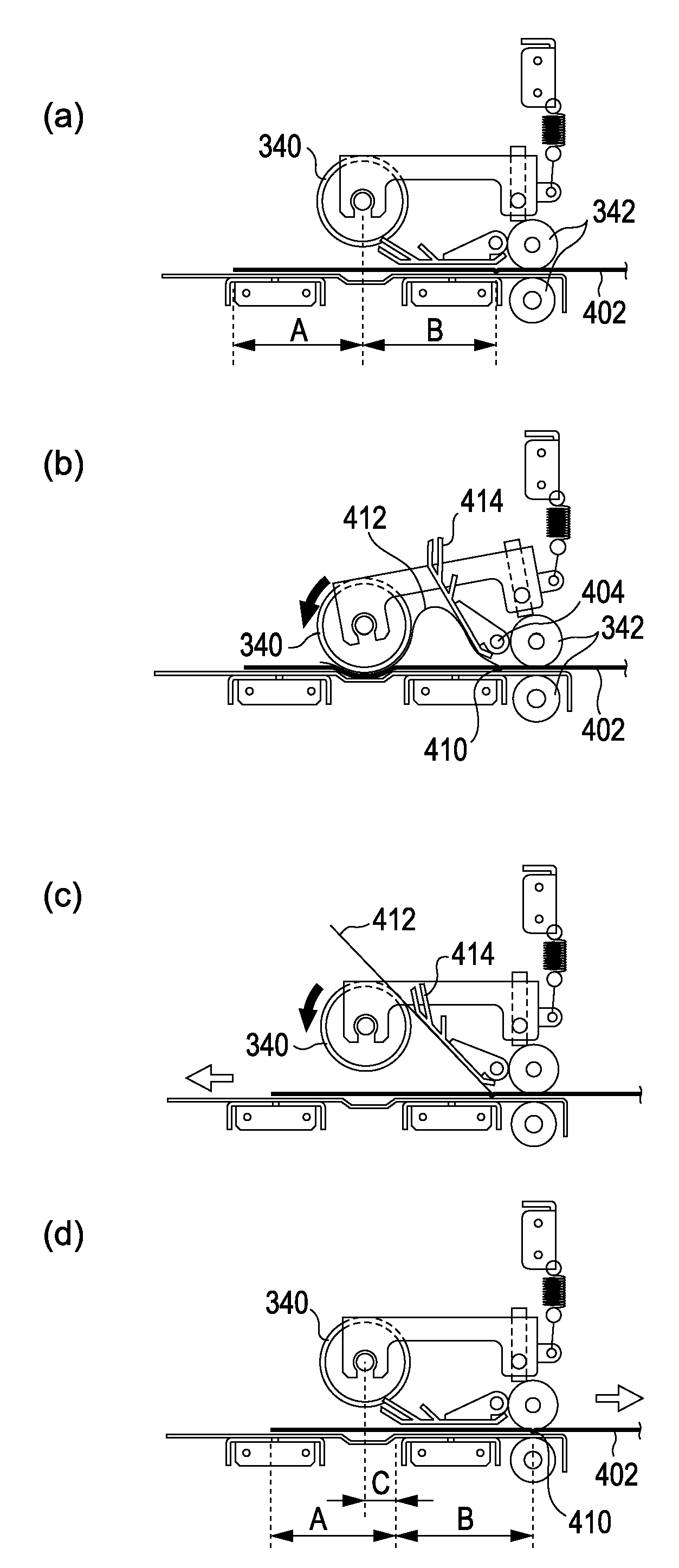

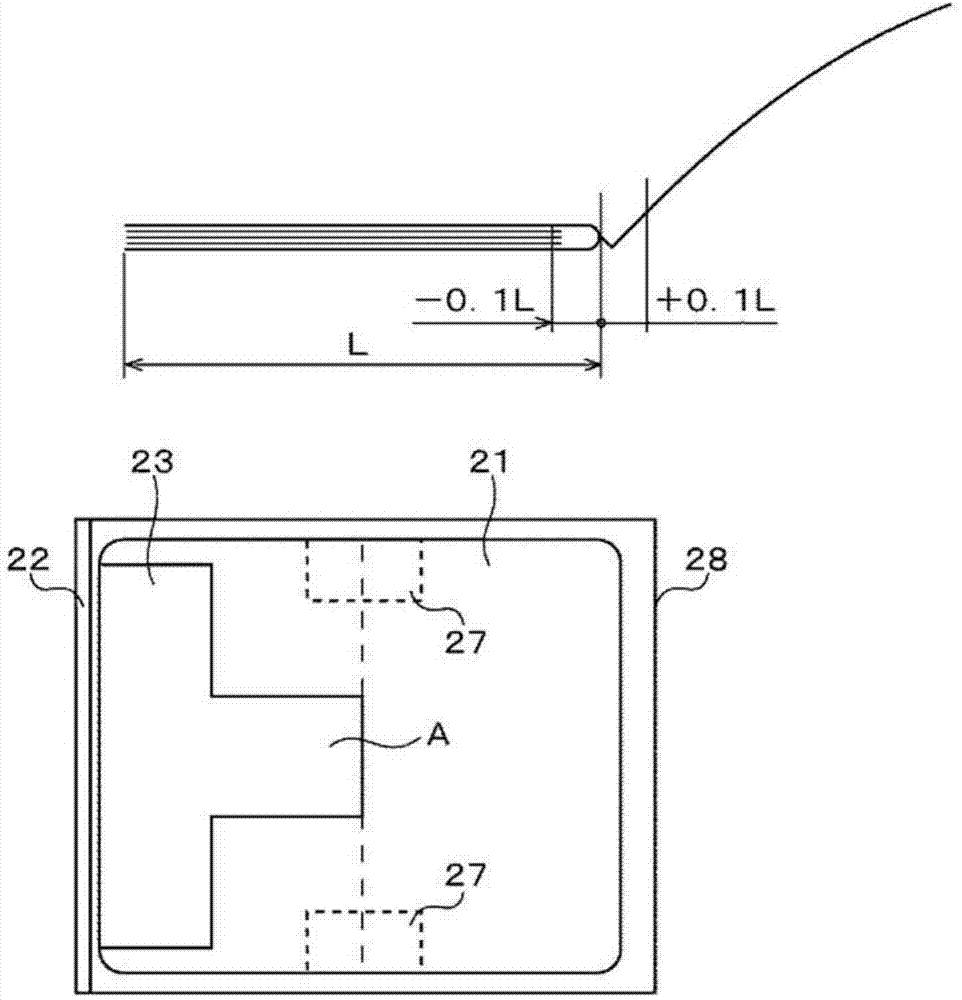

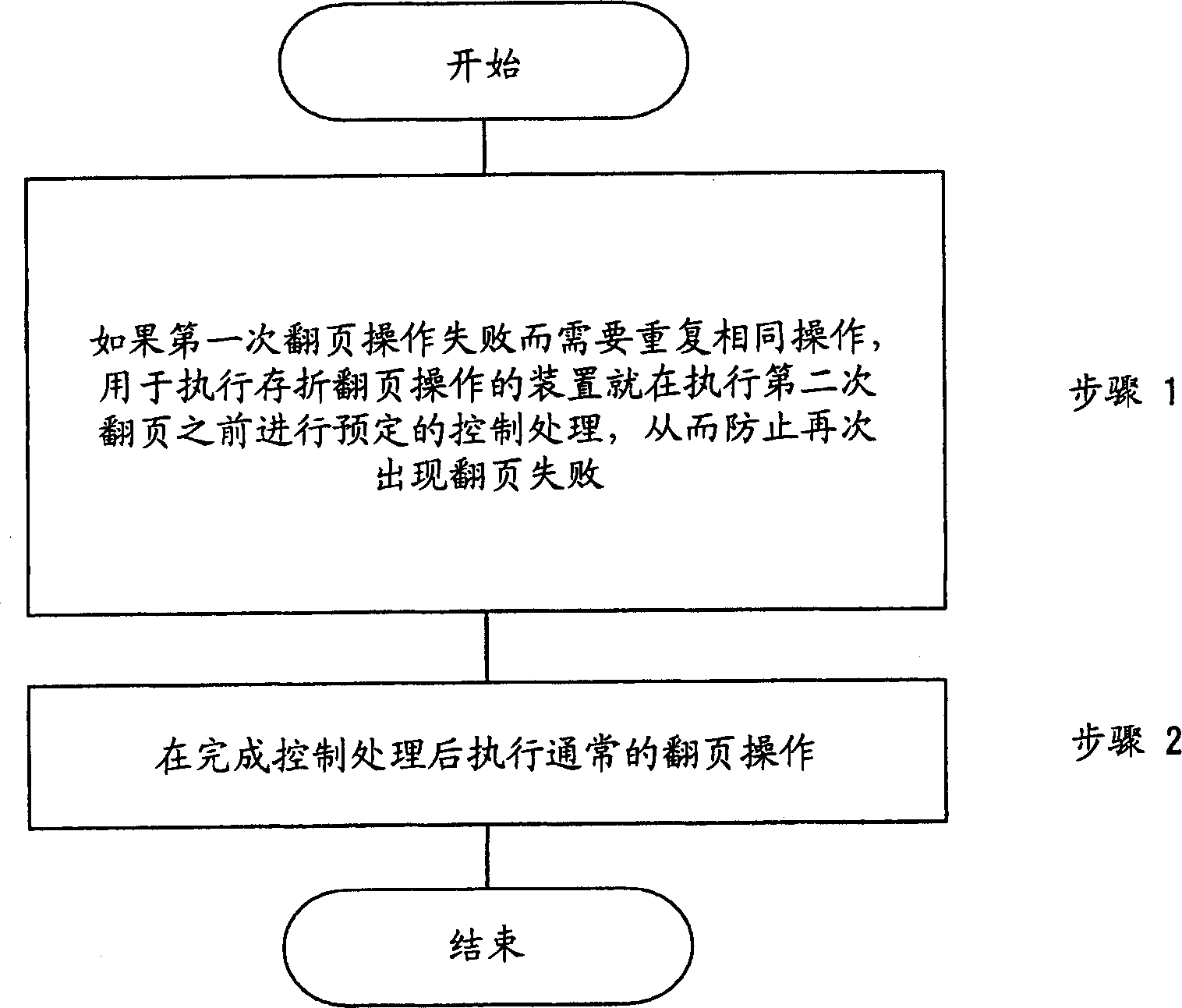

Passbook page turn over operation control method and device

InactiveCN1886269AImprove the success rate of page turningComplete banking machinesAutomatic teller machinesPassbookComputer engineering

There is provided a passbook page turn over operation control method and device capable of improving the successful page turn over ratio. The device performs a passbook page turn over operation. When the first trial of page turn over operation has failed, the page turn over operation is repeatedly performed. In this case, before performing the second trial of the page turn over operation, a predetermined control process preventing failure of page turn over operation is performed (step 1) and then the normal page turn over operation is performed (step 2). By performing the control process, it is possible to improve the successful turn over operation ratio.

Owner:FUJITSU FRONTECH LTD

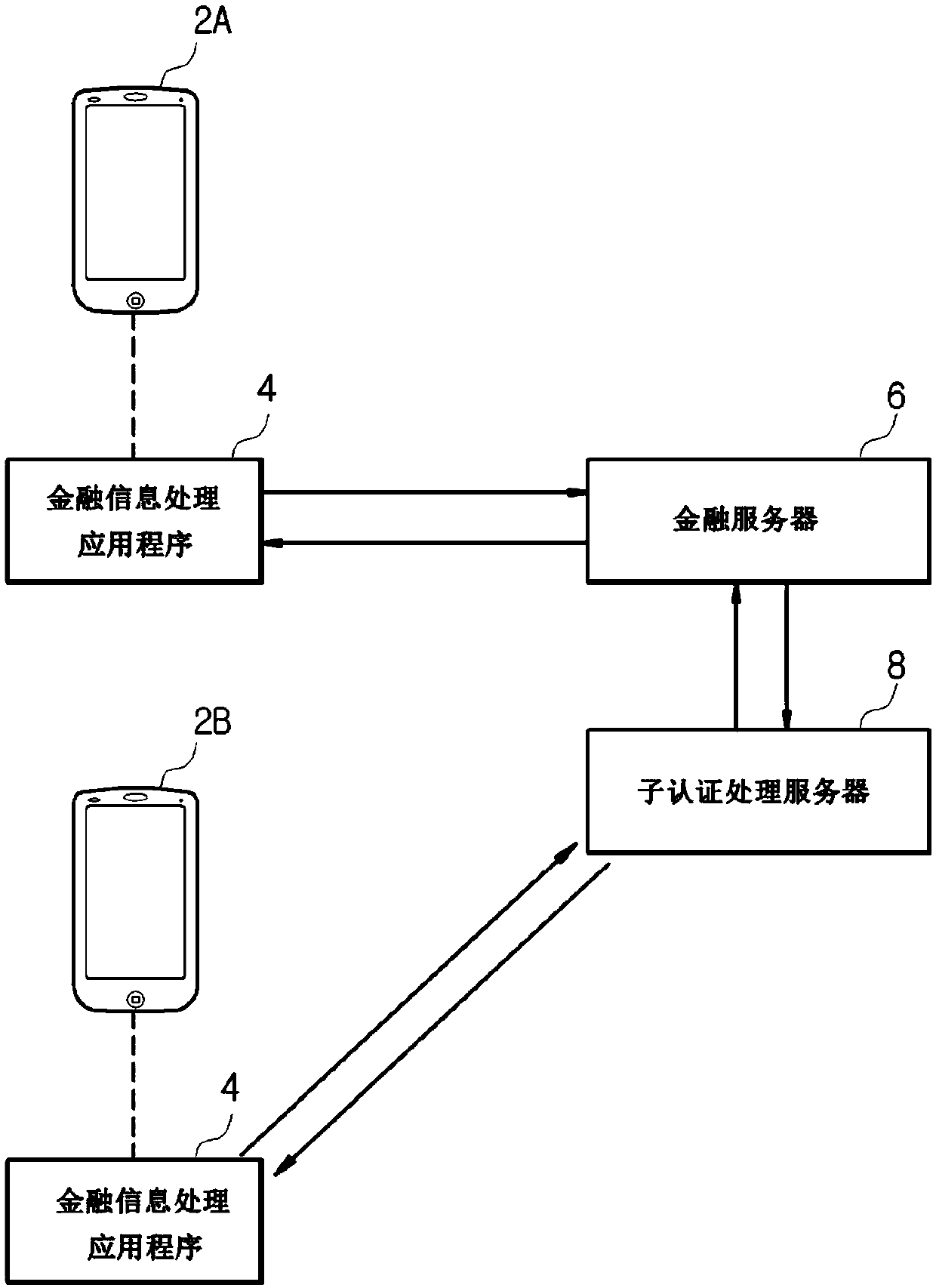

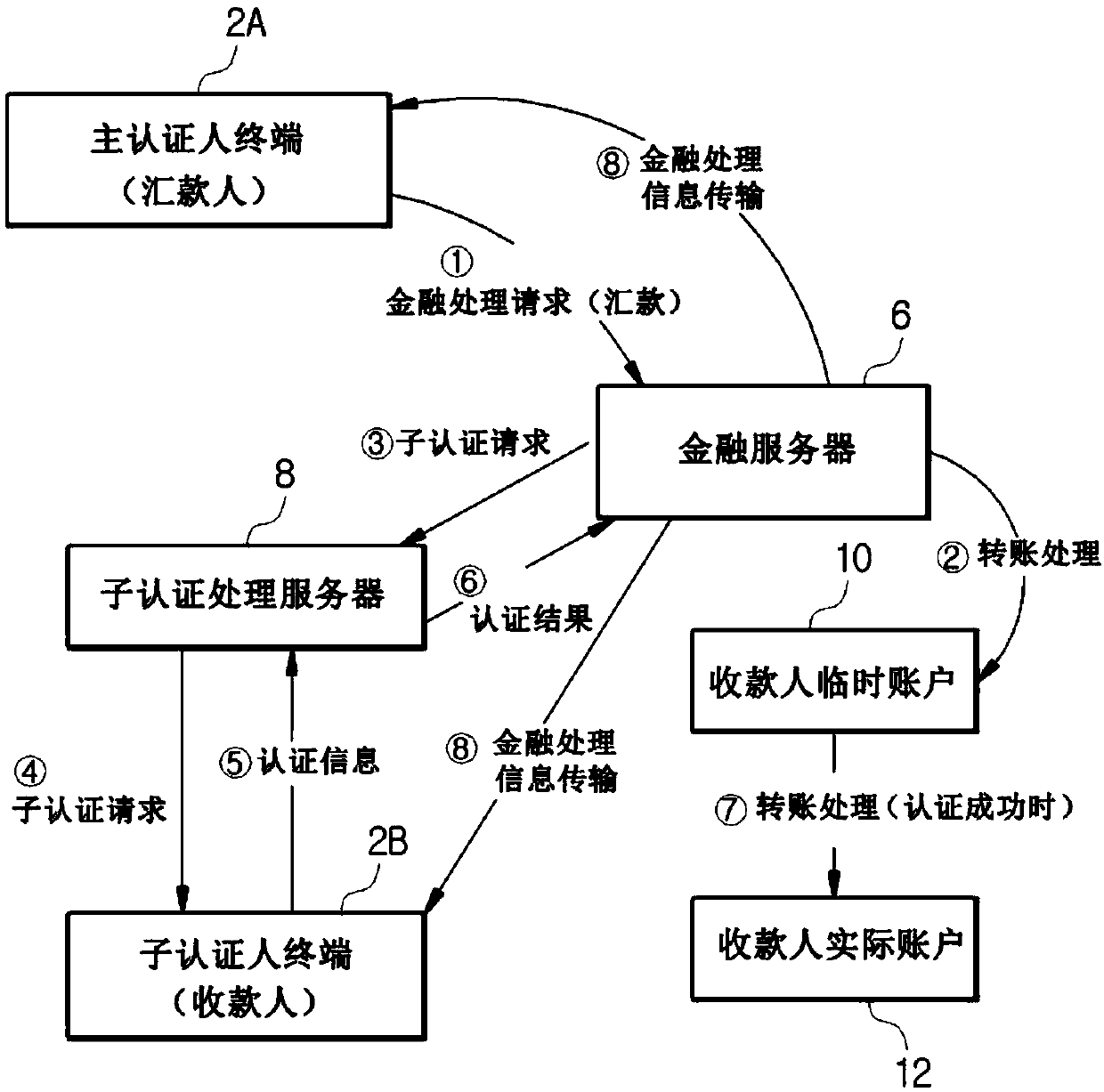

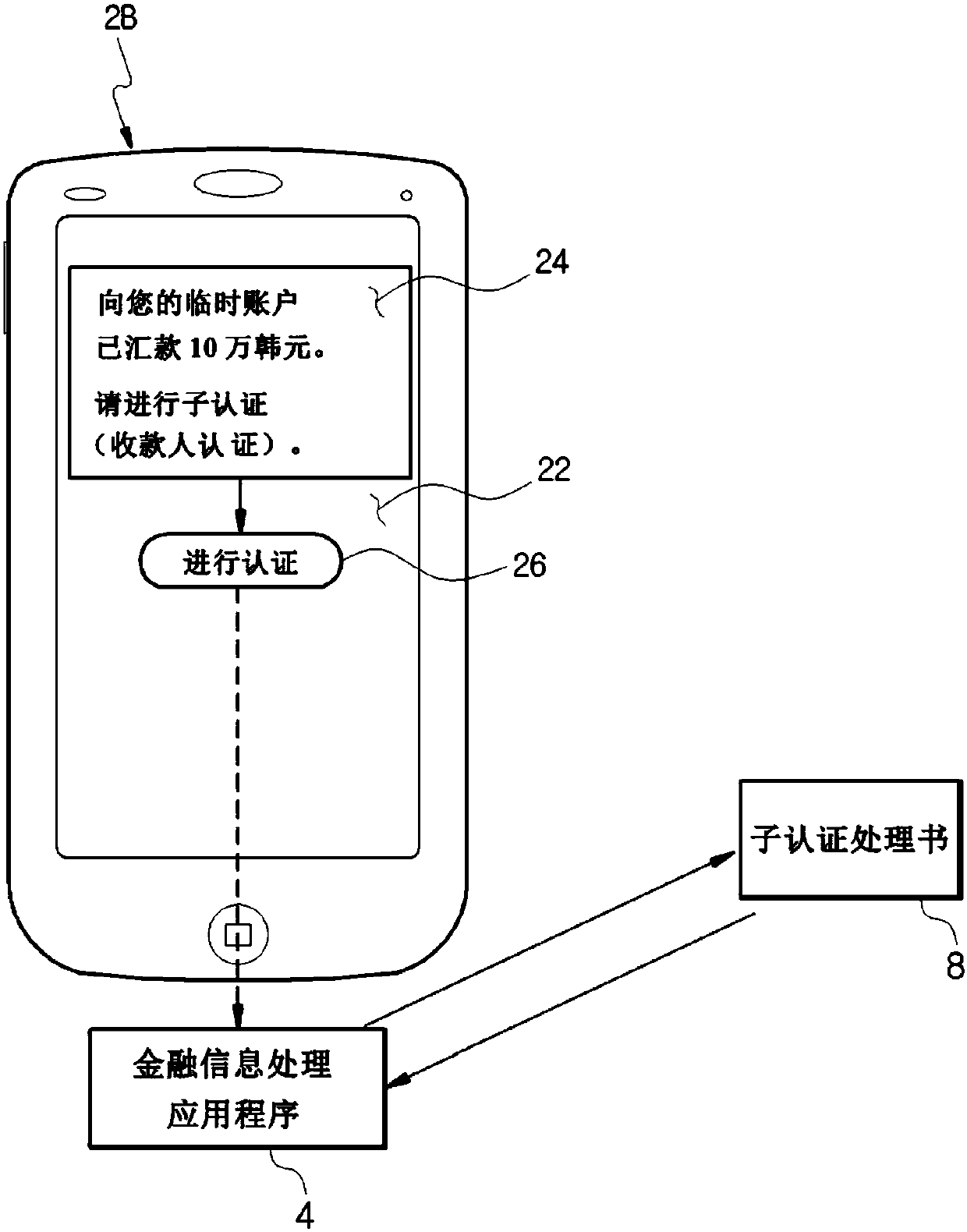

Customized financial processing system using sub-authentication, and method therefor

InactiveCN107710255ASafe Credit TransactionFinanceUser identity/authority verificationProcess systemsHigh probability

The present invention relates to a customized financial process system using sub-authentication and a method therefor, the method comprising the steps of: pre-registering authentication information about a remittee; performing remittance processing after the authenticity of the remittee is proven when a remittance is requested; if an acquaintance of a remitter is additionally registered as a sub-authenticator, executing remittance processing when a consent of the acquaintance and the authentication of the remittee are simultaneously performed; and performing additional complex authentication for a low-grade rated account having a high probability of being a counterfeit deposit bank passbook, by assigning a rating in advance according to account opening and usage information of the remitteeand executing authentication through different authentication options by the rating.

Owner:南基元

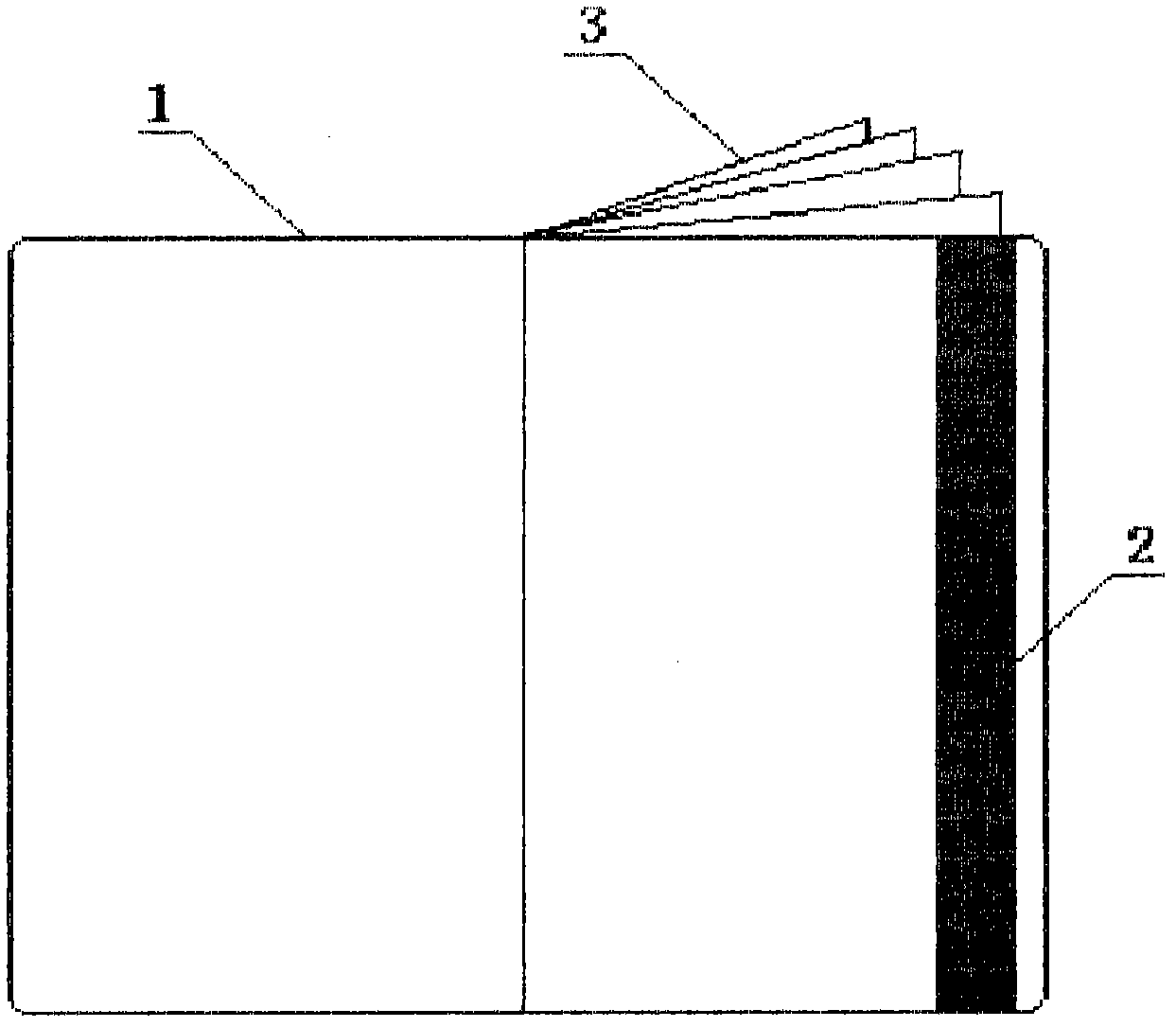

Anti-wrinkle bankbook

InactiveCN102806795AElasticNot easy to wrinkleOther printing matterInformation cardsPassbookEngineering

The invention discloses an anti-wrinkle bankbook, which comprises a cover (1), a magnetic stripe (2) and pages (3) and is characterized in that any surface of the cover (1) is made of an elastic material. The anti-wrinkle bankbook has the advantages of simple structure, low manufacturing cost and wide application range, and can reduce the trouble and adverse effect in the operation and using process of people by only modifying any surface of the original bankbook.

Owner:刘振安

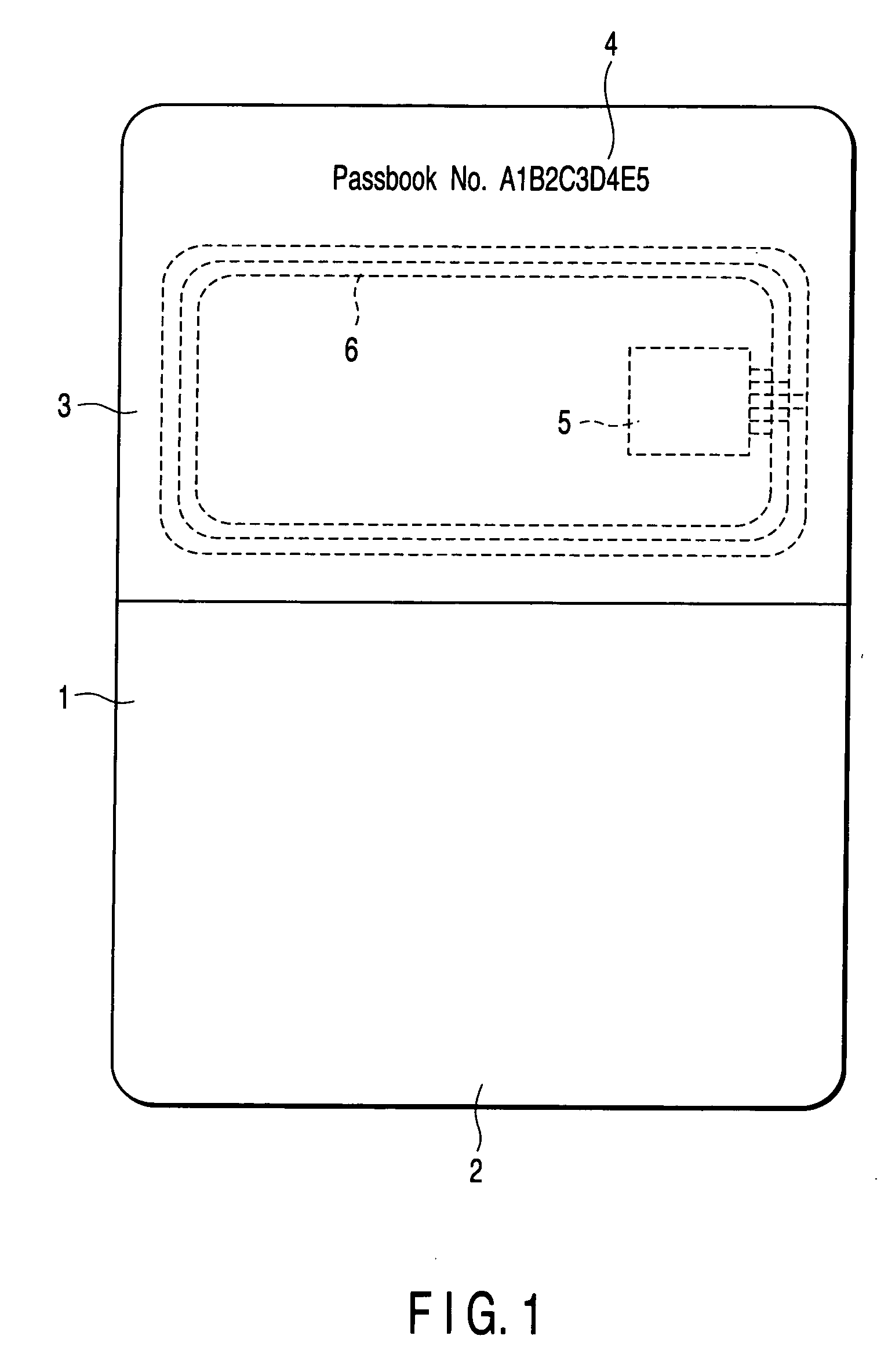

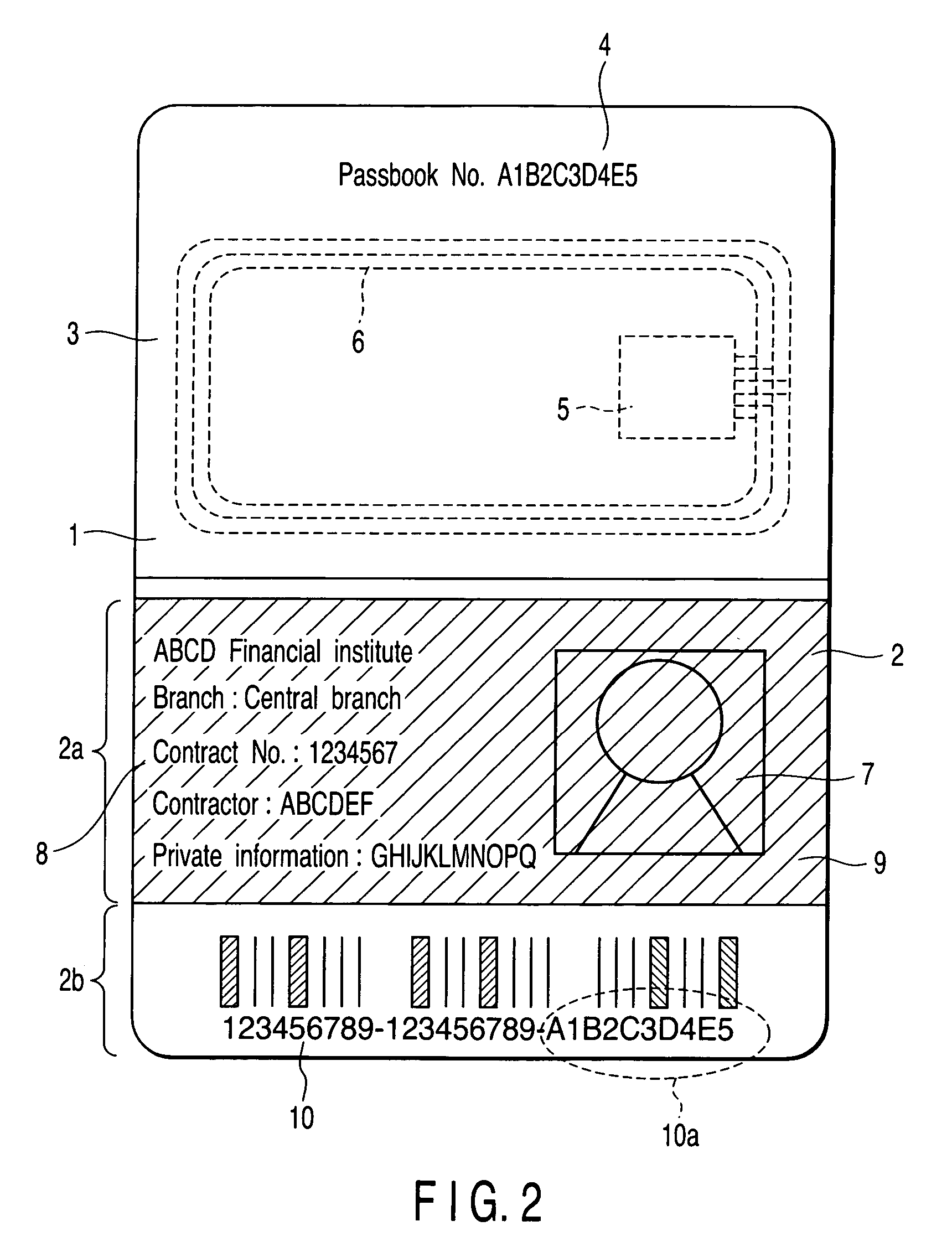

Printing apparatus and printing method

InactiveUS20060219784A1Improve stealth performanceLow running costCooking-vessel materialsTypewritersPassbookComputer science

A passbook printing apparatus prints a color face image and private information of the owner of a passbook in the passbook with a built-in IC chip including a passbook number recorded previously. In this time, the passbook printing apparatus first reads the passbook number from the IC chip built in the passbook, creates private information including the read passbook number, face image of the owner and printing information, and prints the printing information reflecting the passbook number read from the IC chip on a printing page of the passbook.

Owner:KK TOSHIBA

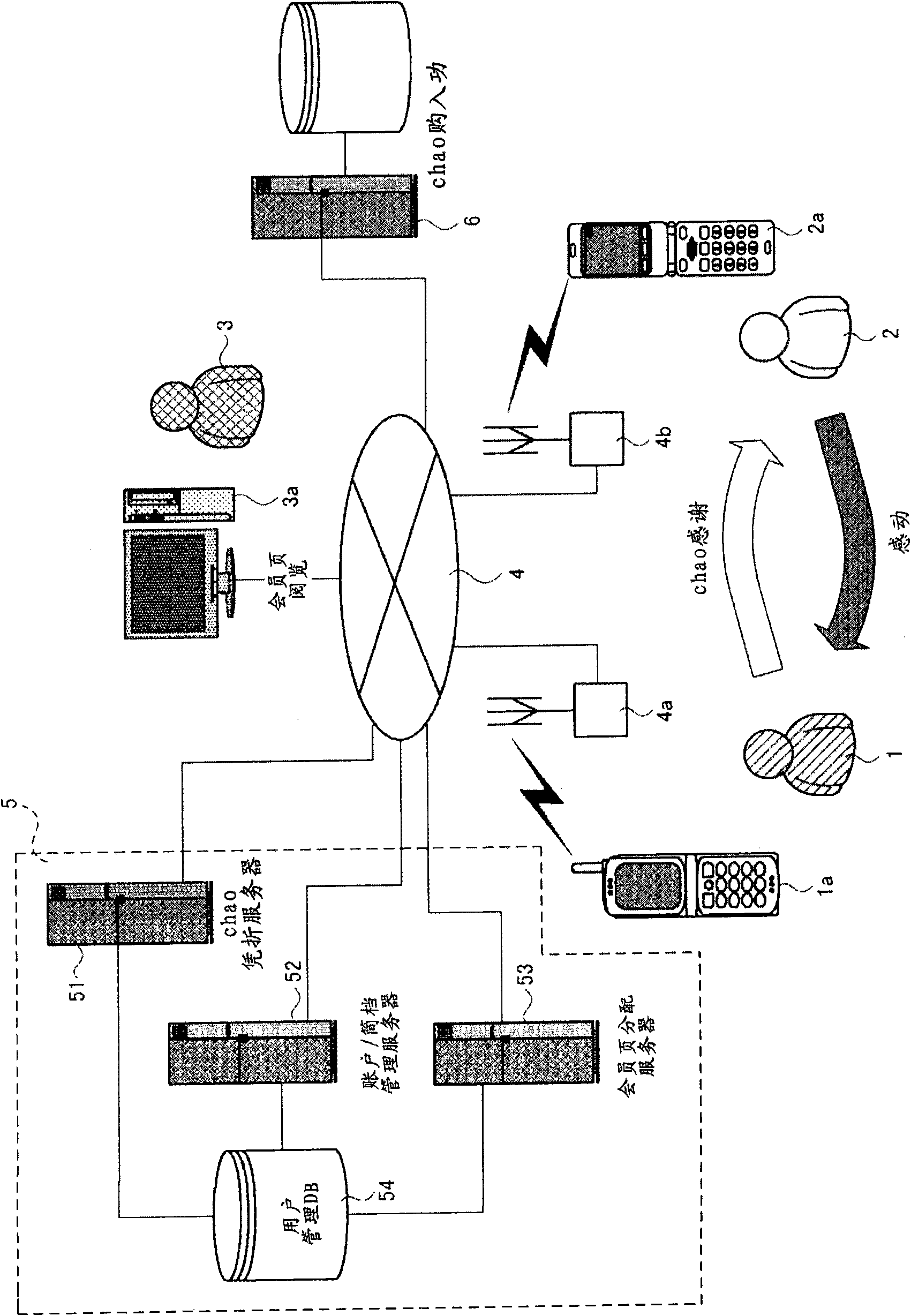

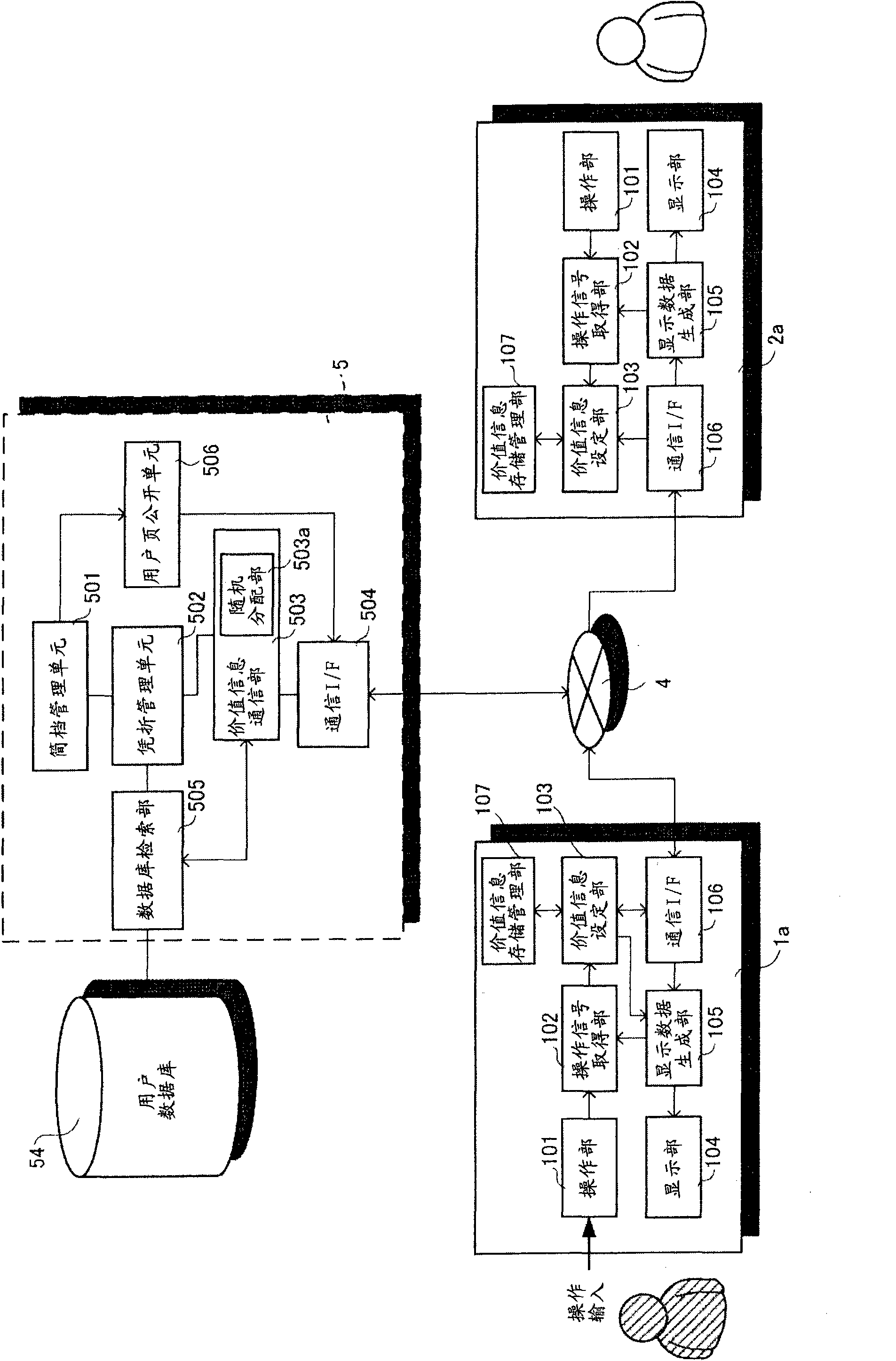

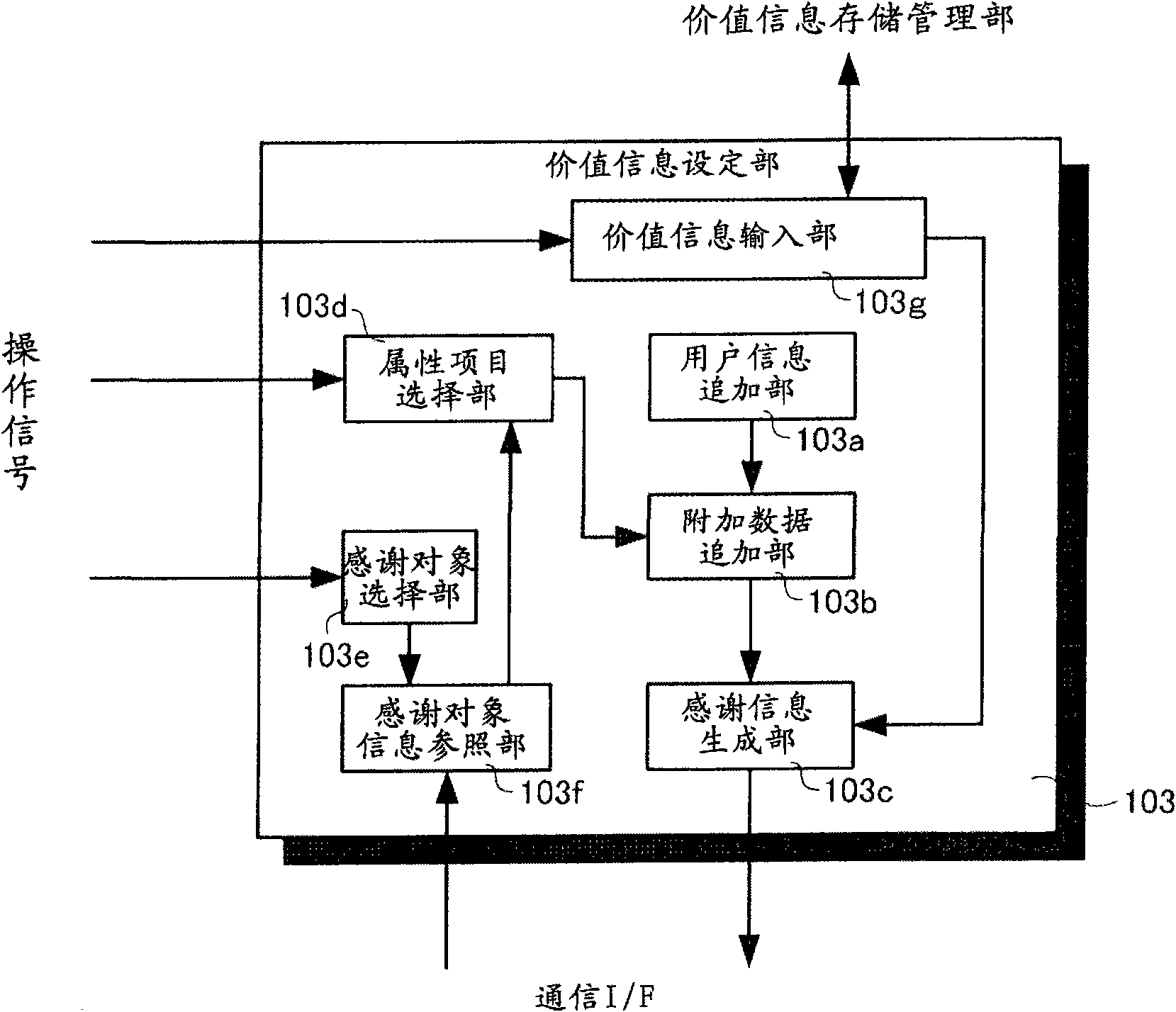

Gratitude providing system and gratitude providing method

A gratitude providing system is configured to present gratitude expressed as visual value information (chao) to the other user (gratitude presentee) (2) who has given a moved or kind act. The gratitude providing system specifies attribute items (job) owned by the user (2) of the gratitude presentee; transmits predetermined chao determined by the user from a communication terminal device (1a); stores the chao, which a user eventually has owned, at a chao passbook in connection with the job owned by the user; sets each user job level in accordance with each user job recorded and held at the chaopassbook and each user chao quantity or a presenting frequency, and publicly discloses this set job level of the user (2) through a communication network. According to the present invention, the feeling of gratitude as visual value information can be mutually communicated with a presentee who has given a moved or kind act, and it is further stored, so that links between users can be globally developed and so that they can be more closely related.

Owner:株式会社 超

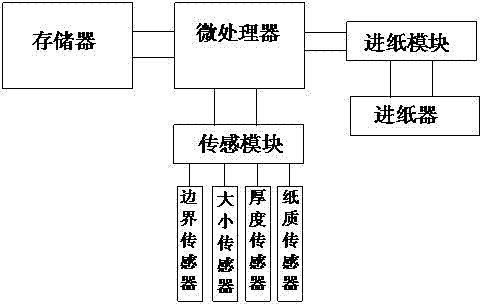

Aligning device for passbook printer

InactiveCN102529438APrecise position controlAccurate stroke controlOther printing apparatusPrint mediaPassbook

The invention discloses an aligning device for a passbook printer. The aligning device comprises a microprocessor, a sensor module and a paper feeding module, wherein the sensor module and the paper feeding module are respectively connected with the microprocessor, the sensor module is externally connected with a sensor, the sensor senses properties of print media and transmits property data to the microprocessor, the microprocessor carries out judgment according to the transmitted property data and sends print media inputting commands to the paper feeding module, the paper feeding module is externally connected with a paper feeding device, and the paper feeding device is used for controlling the inputting of the print media. The sensor is used for detecting paper feeding positions, the print media inputting can be carried out under the control of the microprocessor, so that positions and strokes of the print media can be controlled accurately, a phenomenon that printed information is printed on fault positions by a print head can be avoided, the print accuracy and the print efficiency can be effectively improved.

Owner:SHENZHEN CATIC INFORMATION TECH IND

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com