Patents

Literature

251 results about "Exposure data" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Exposure data definition, exposure data meaning | English dictionary. exposure. a the act of exposing a photographic film or plate to light, X-rays, etc. b an area on a film or plate that has been exposed to light, etc.

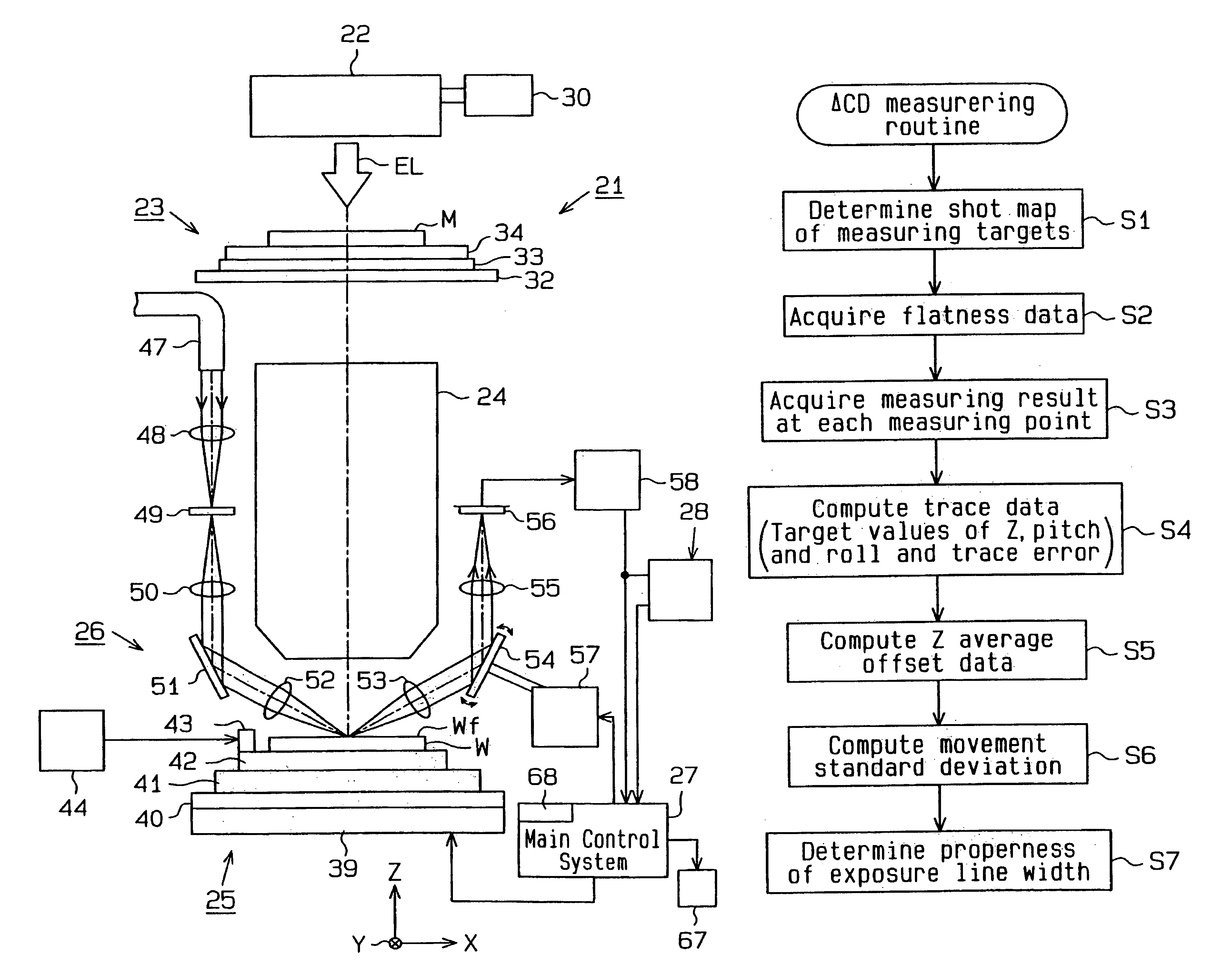

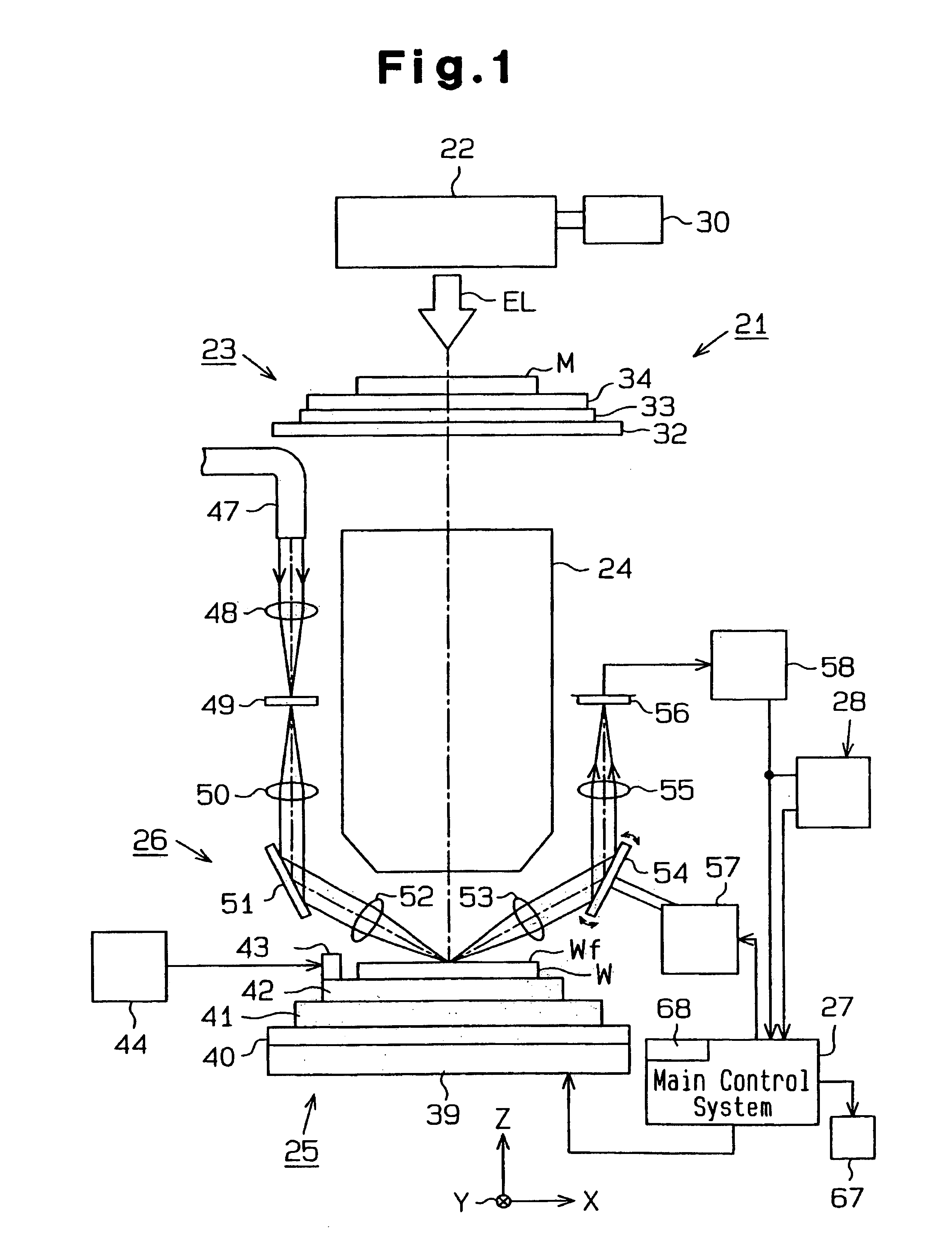

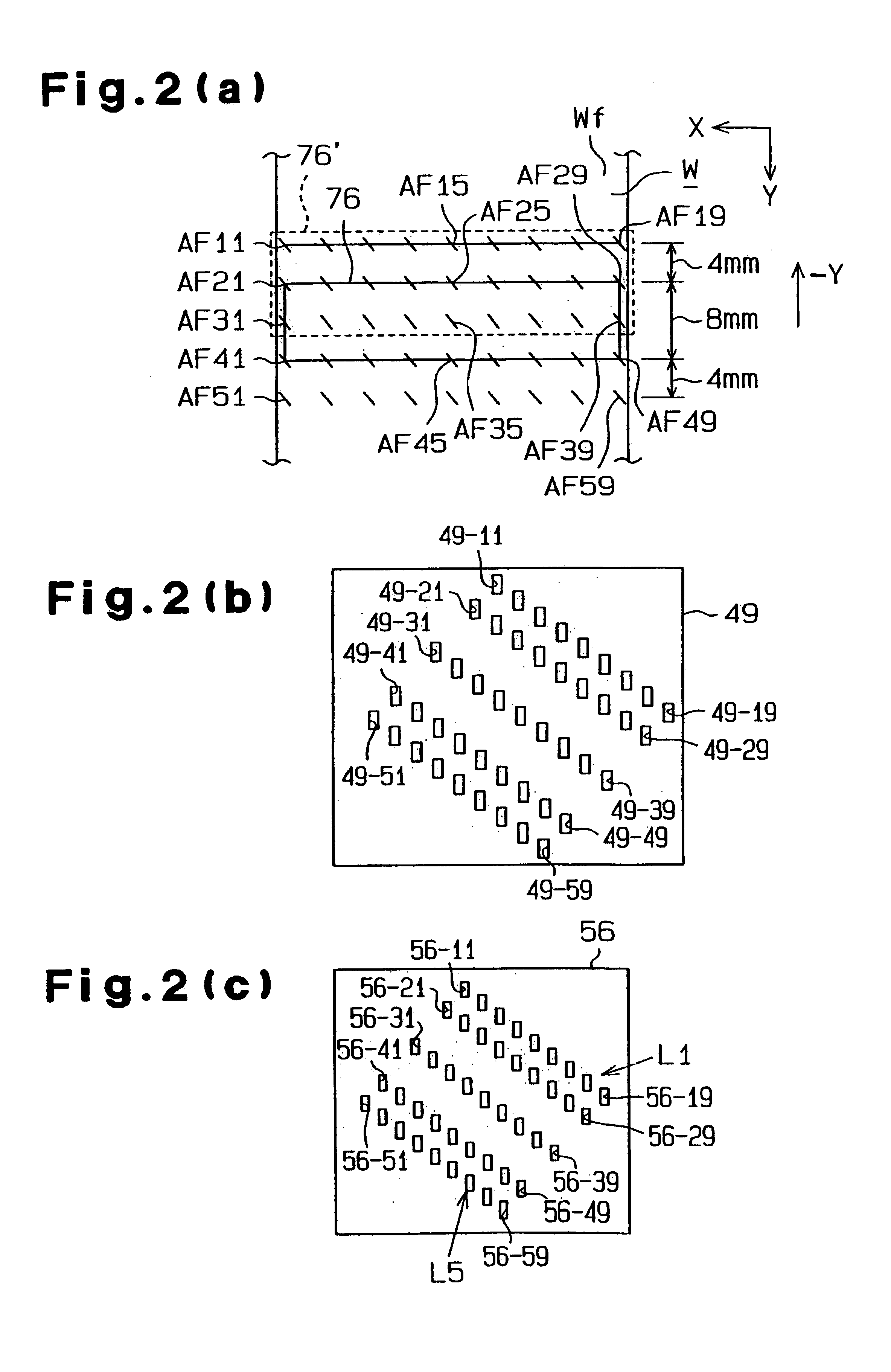

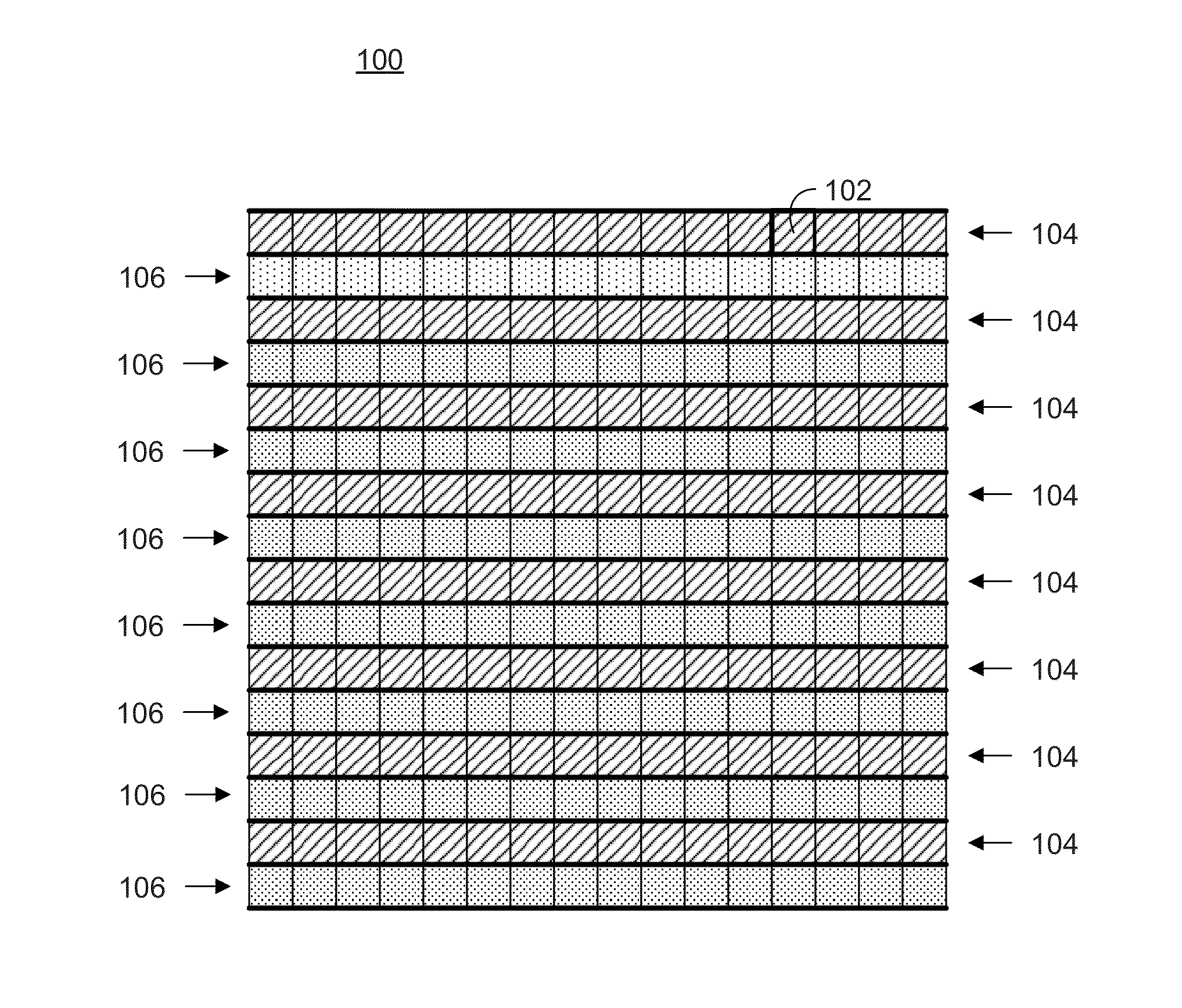

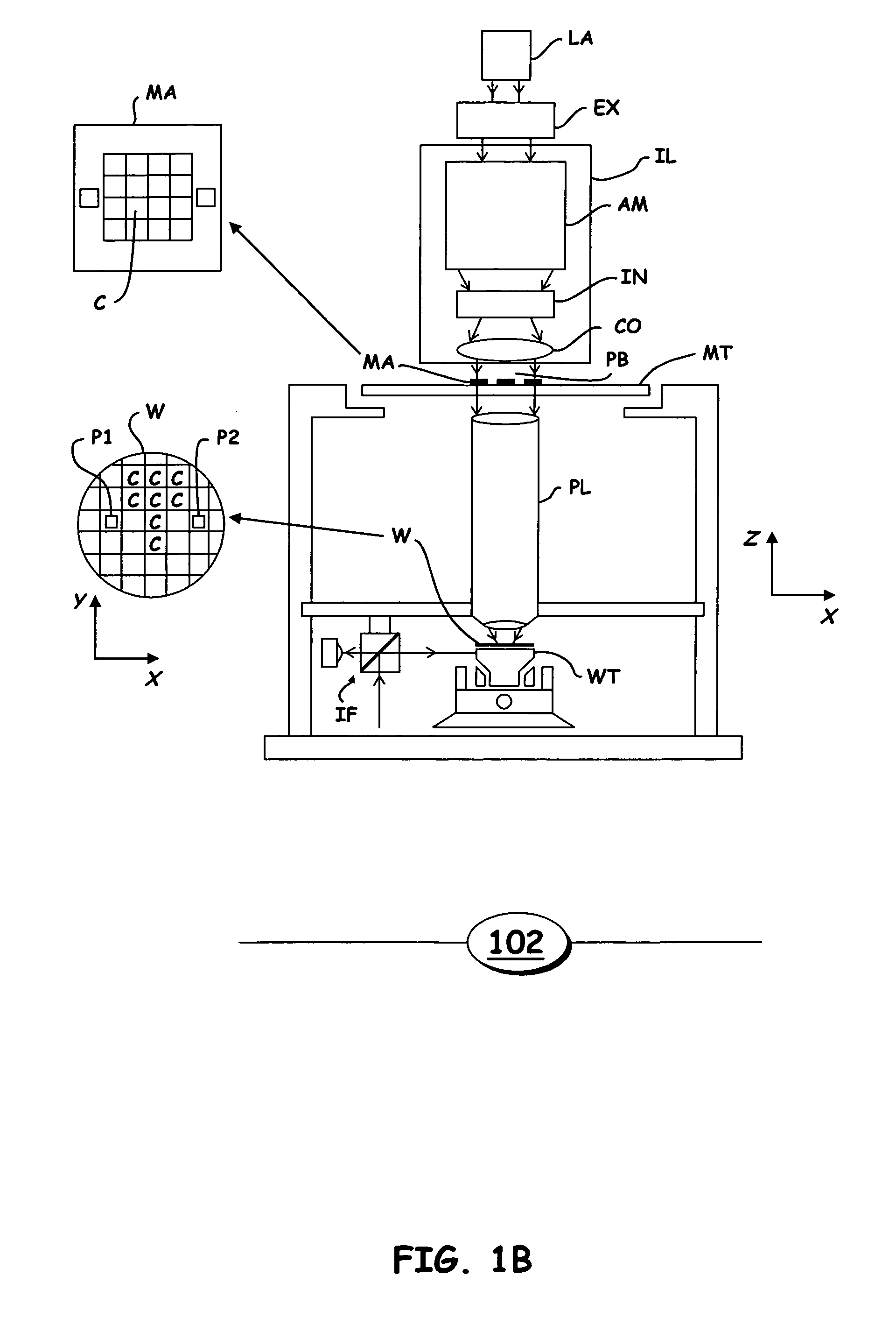

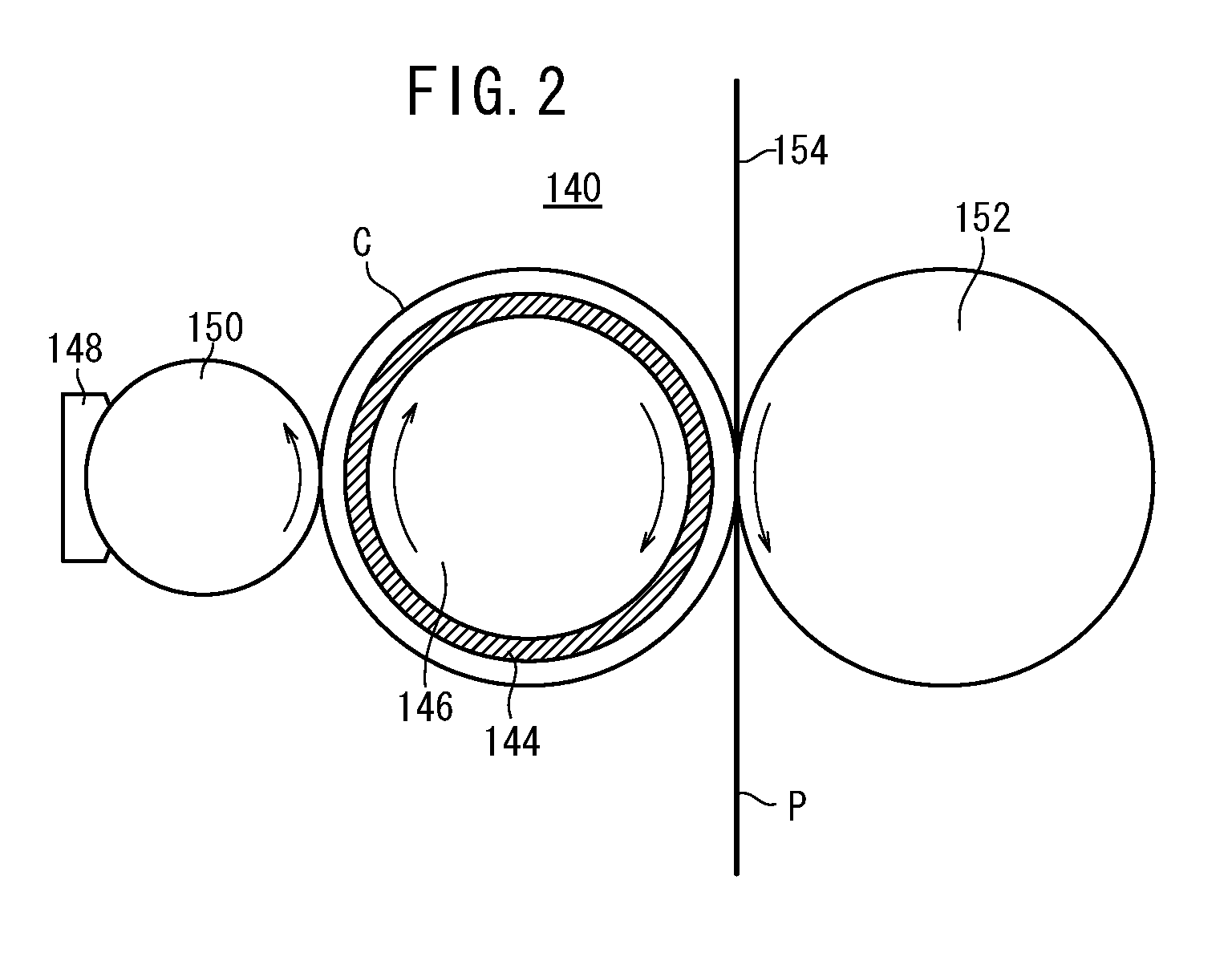

Scanning exposure apparatus

InactiveUS6992751B2Quick analysisUsing optical meansPhotomechanical exposure apparatusLine widthBiomedical engineering

A scanning exposure apparatus which promptly analyzes a cause for a variation in exposure line width. The scanning exposure apparatus includes a mask stage on which a mask is placed, a wafer stage on which a wafer is placed, a focusing mechanism which detects surface position information of the wafer and adjustment means which adjusts the surface position of the wafer. Control means acquires pose information of the wafer adjusted by the adjustment means at the time of exposure and stores the pose information in a memory in association with preacquired surface shape information of an exposure area. A state in which the exposed surface of the wafer has been exposed with respect to exposure light is known from the pose information and the surface shape information.

Owner:NIKON CORP

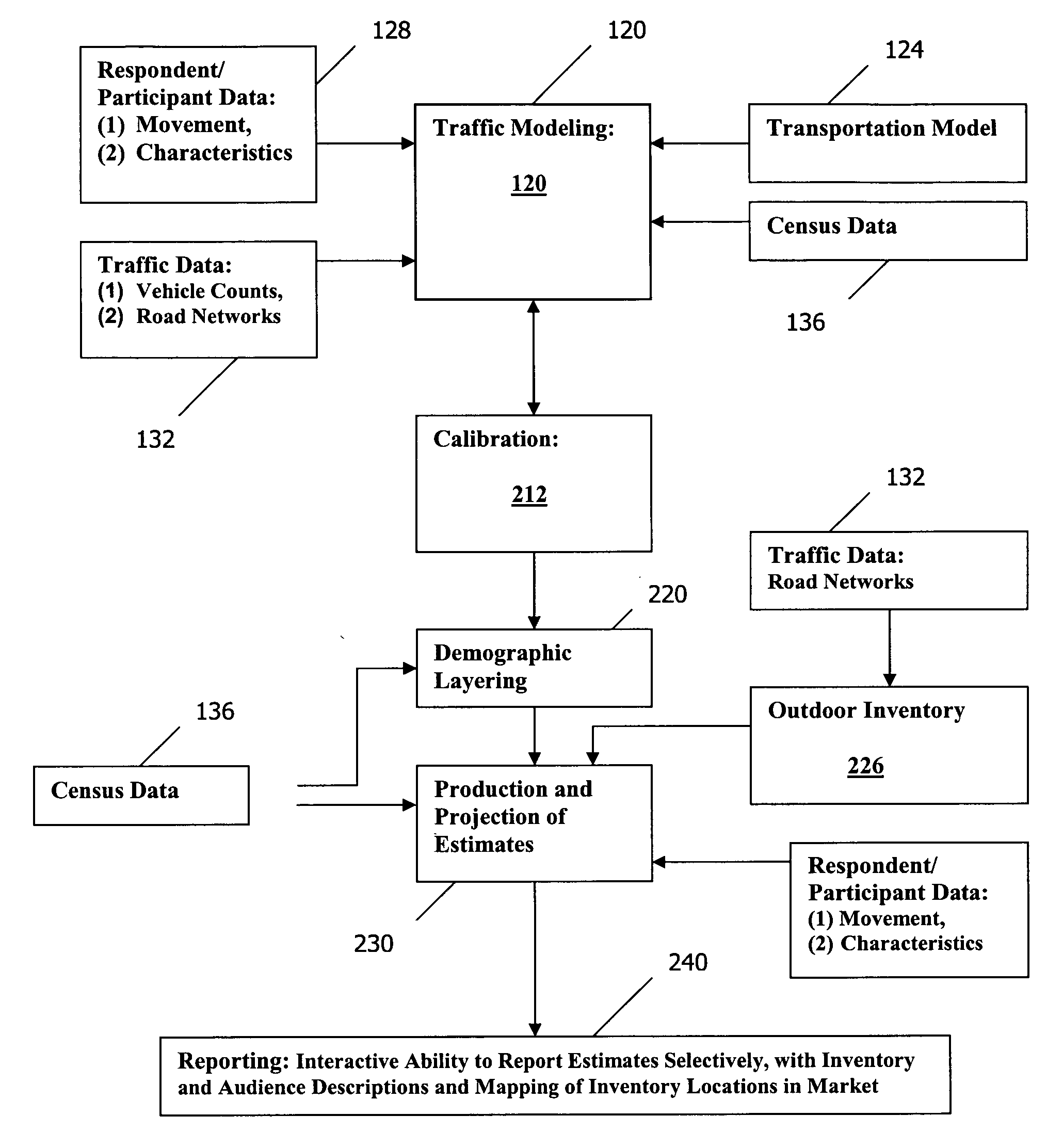

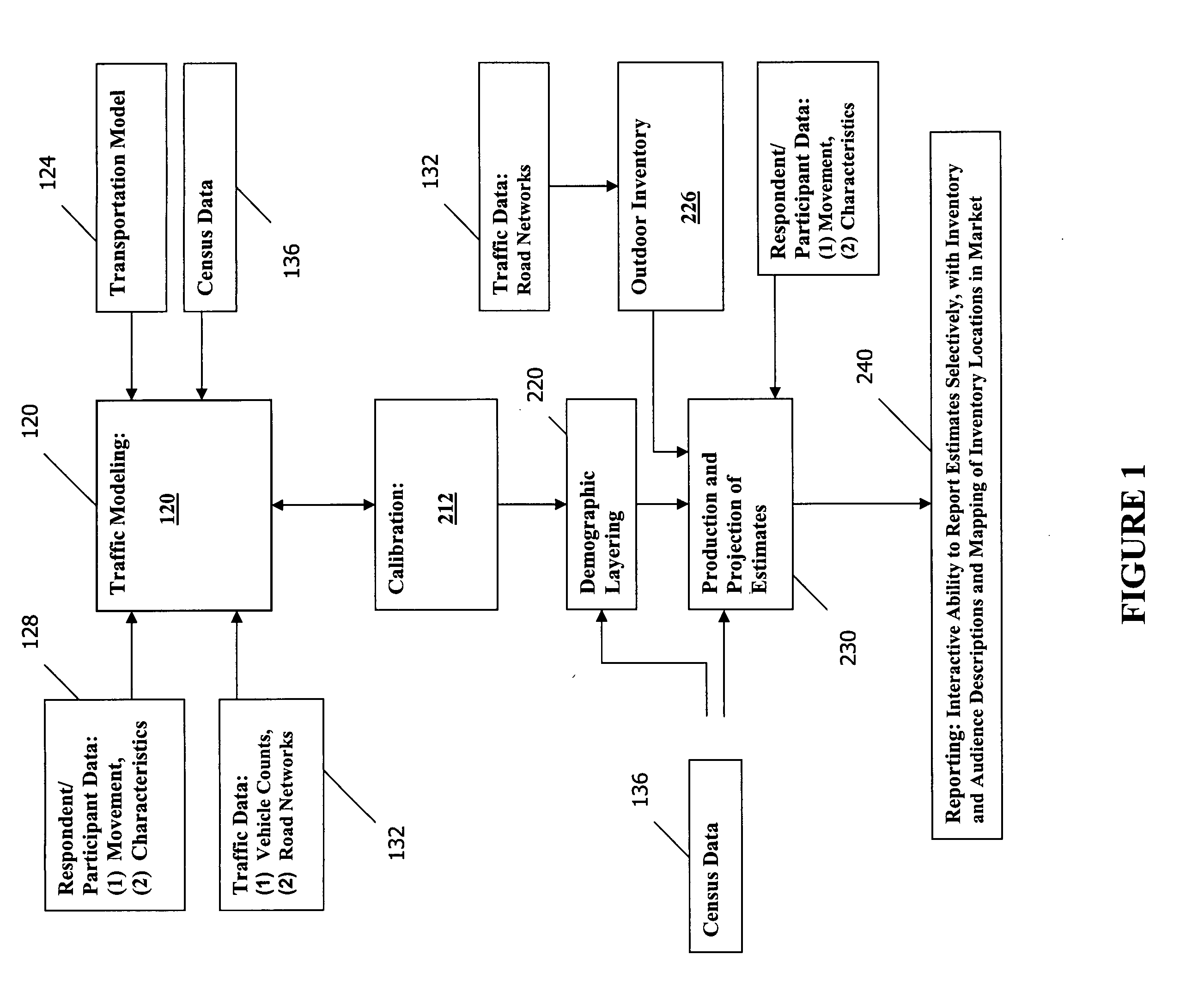

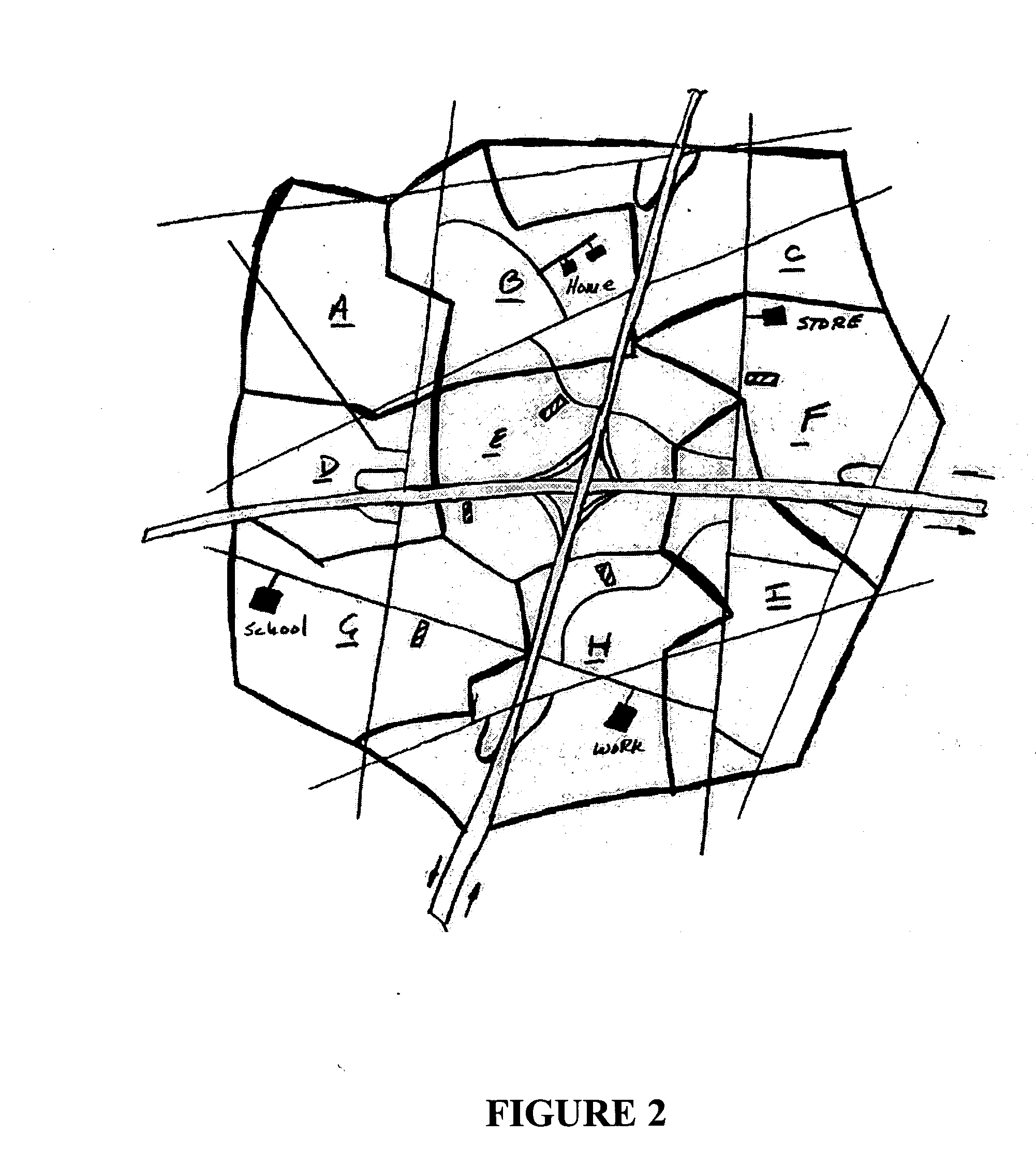

Out-of-home advertising inventory ratings methods and systems

Methods, systems and programs for estimating exposure to outdoor advertising are provided. In certain embodiments, exposure data is produced based on respondent data and traffic data. In certain embodiments, exposure data is produced based on outdoor inventory data and traffic data.

Owner:NIELSEN HLDG NV +1

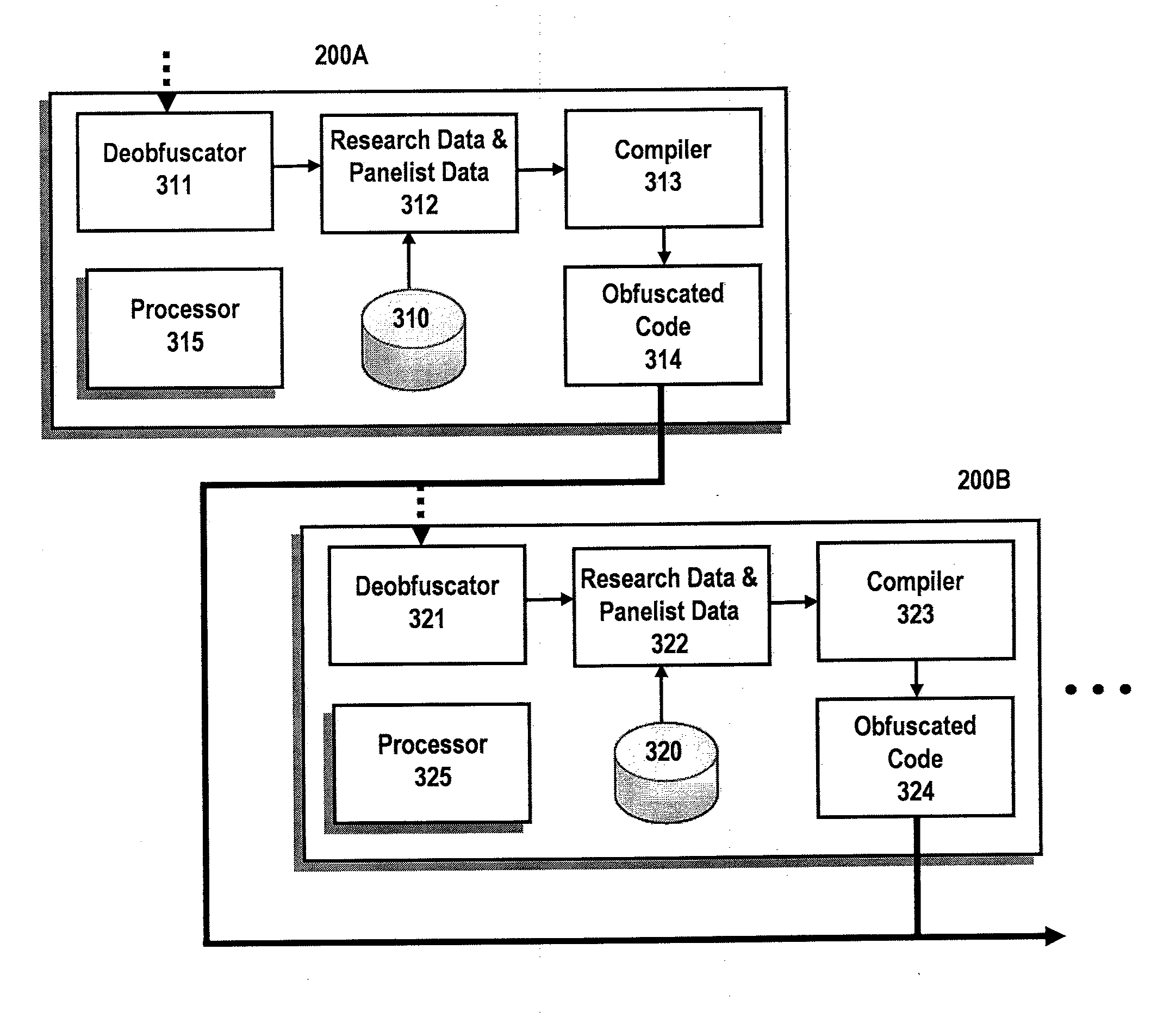

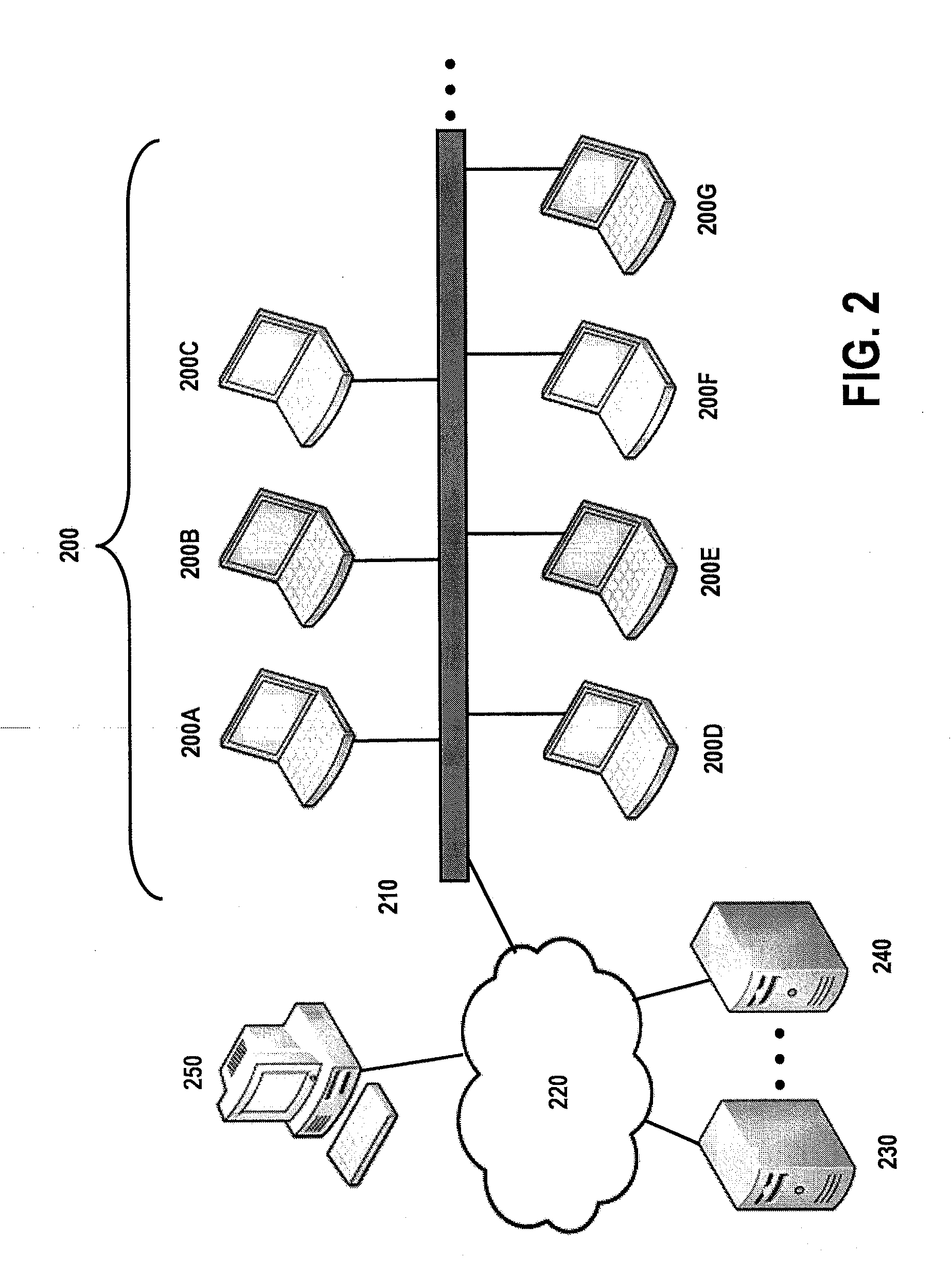

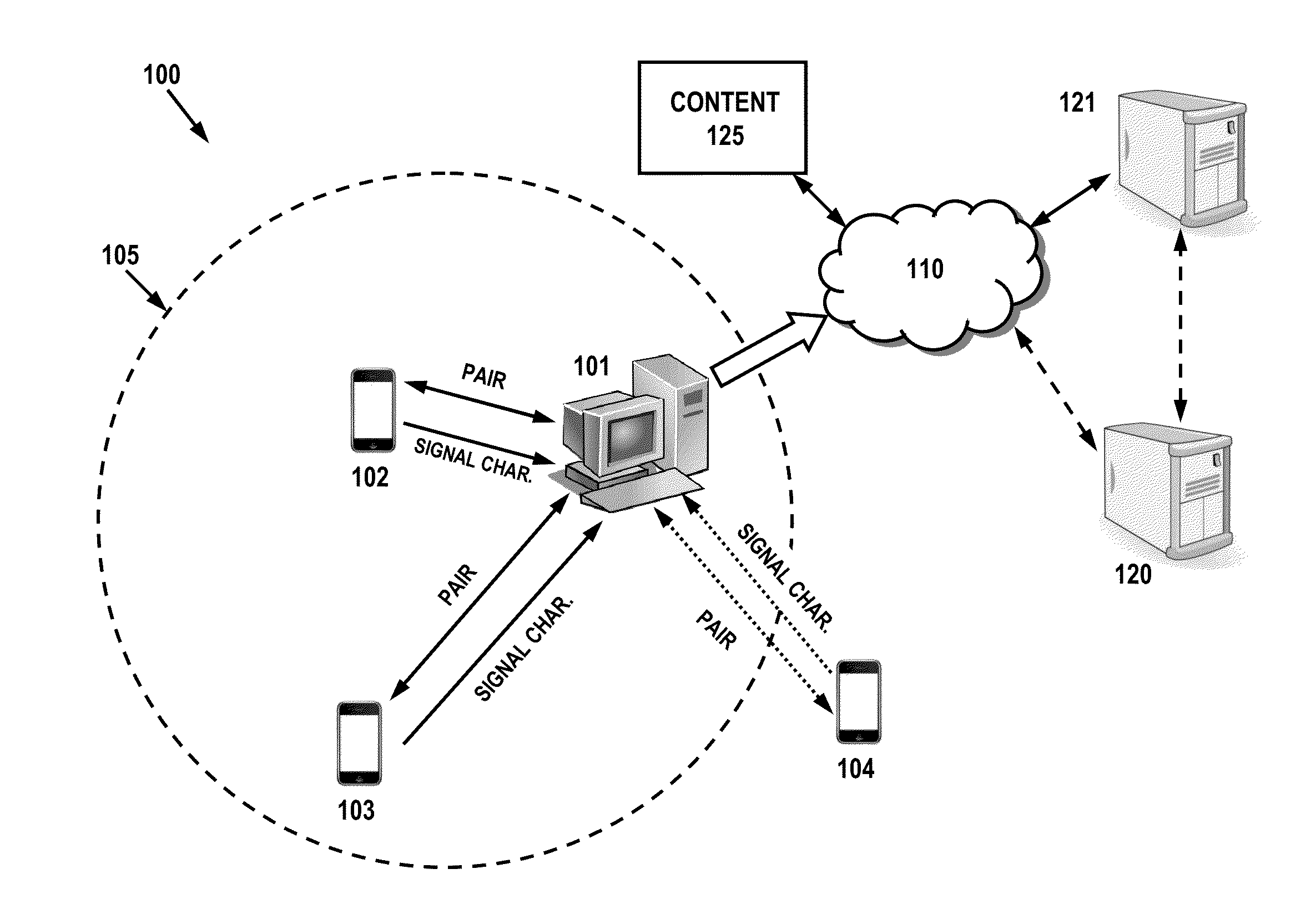

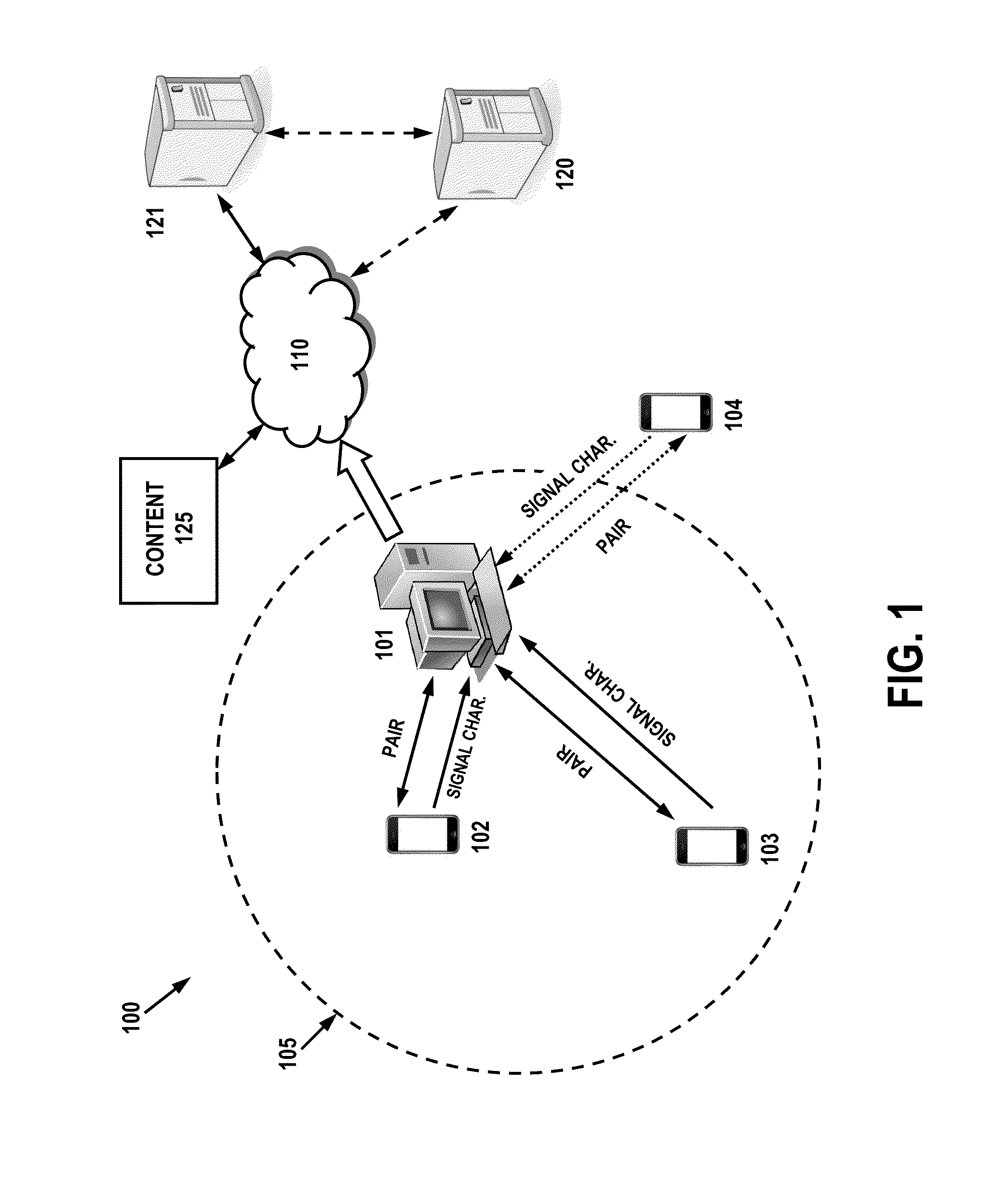

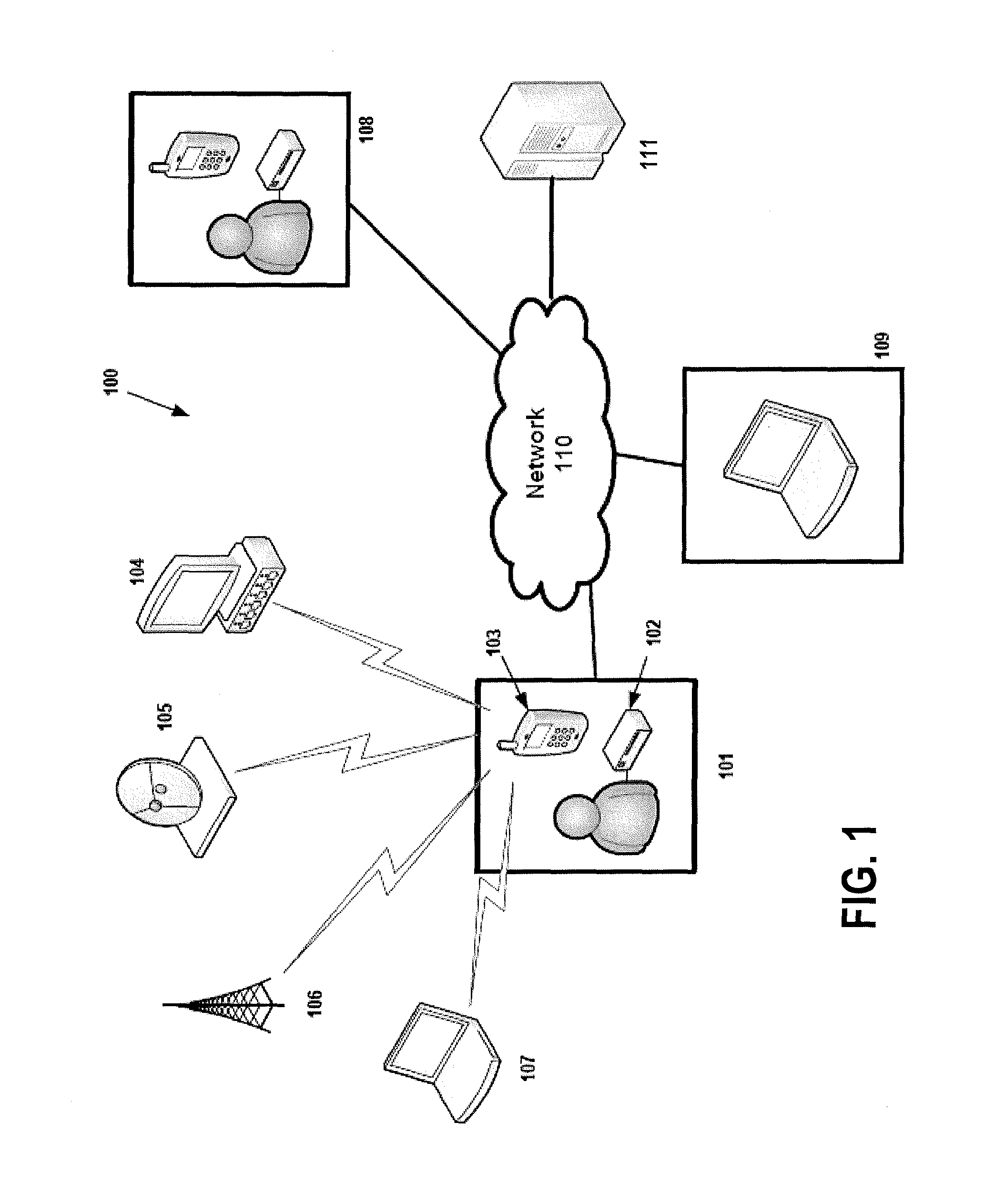

Peer-to-peer privacy panel for audience measurement

InactiveUS20110153391A1Privacy protectionReliable resultsMarket predictionsMultiple digital computer combinationsObfuscationInternet privacy

Systems and methods for operating an anonymous peer-to-peer (“P2P”) privacy panel for audience measurement is disclosed. A plurality of portable devices are configured to record and process research data pursuant to a research operation. Each of the panelists associated with each portable devices provide panelist data to a central site, where the panelist data includes demographic information, previous media exposure data, and other data. In accordance with panelist data, a customized P2P network is created where media exposure data is obfuscated and communicate among portable devices in the network. By utilizing a P2P network together with obfuscation techniques, panelist privacy is greatly increased.

Owner:THE NIELSEN CO (US) LLC +1

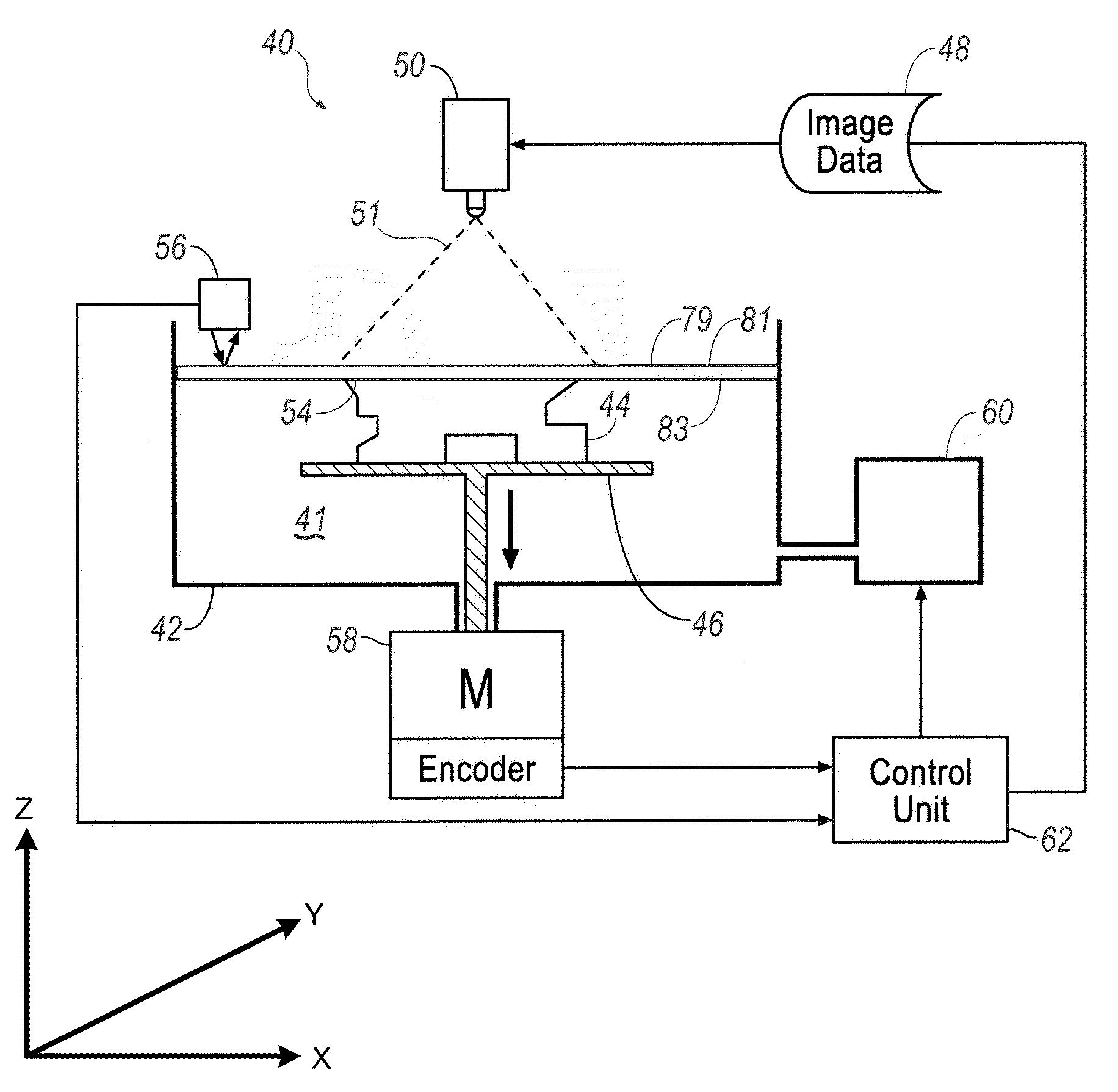

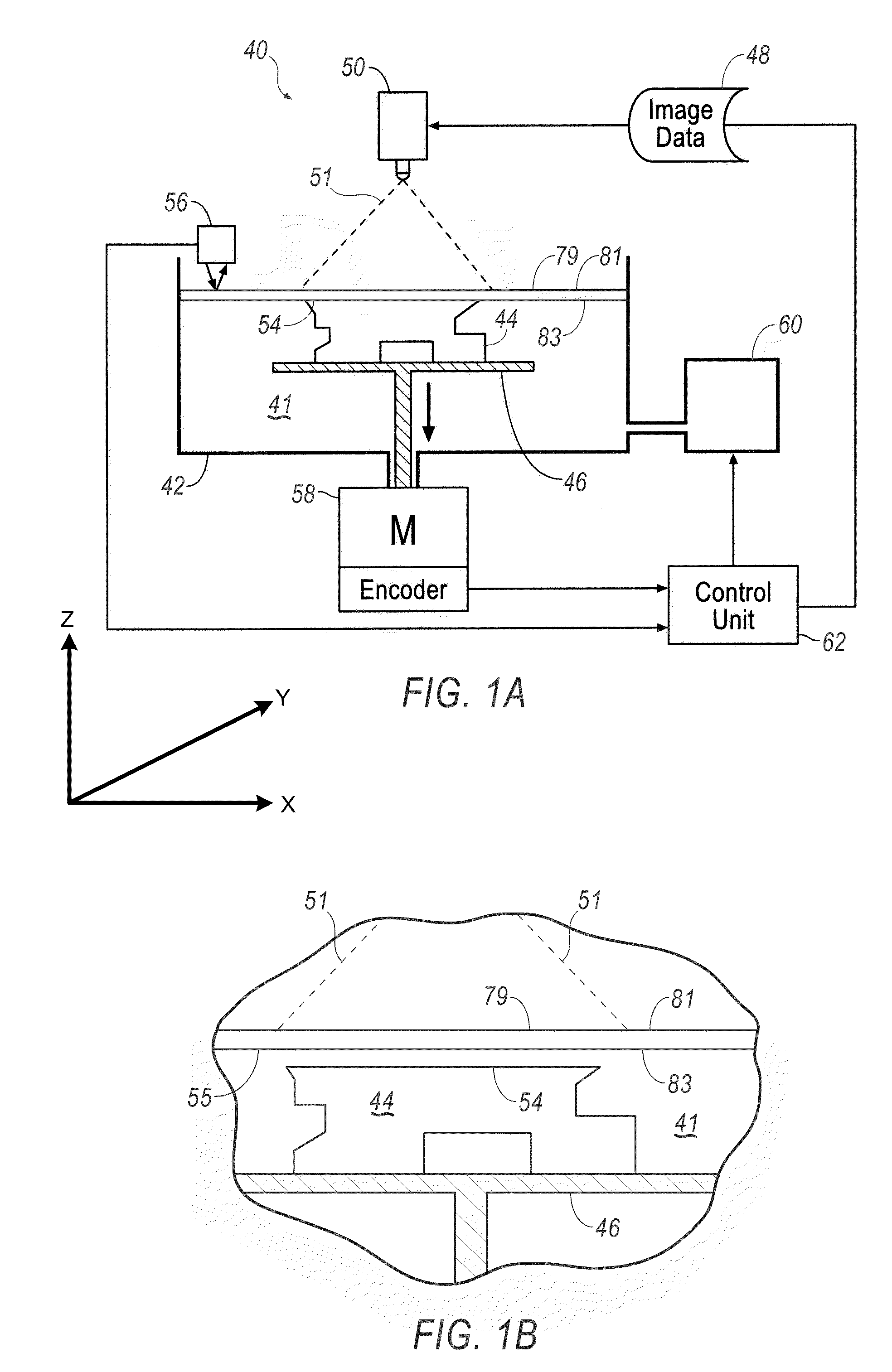

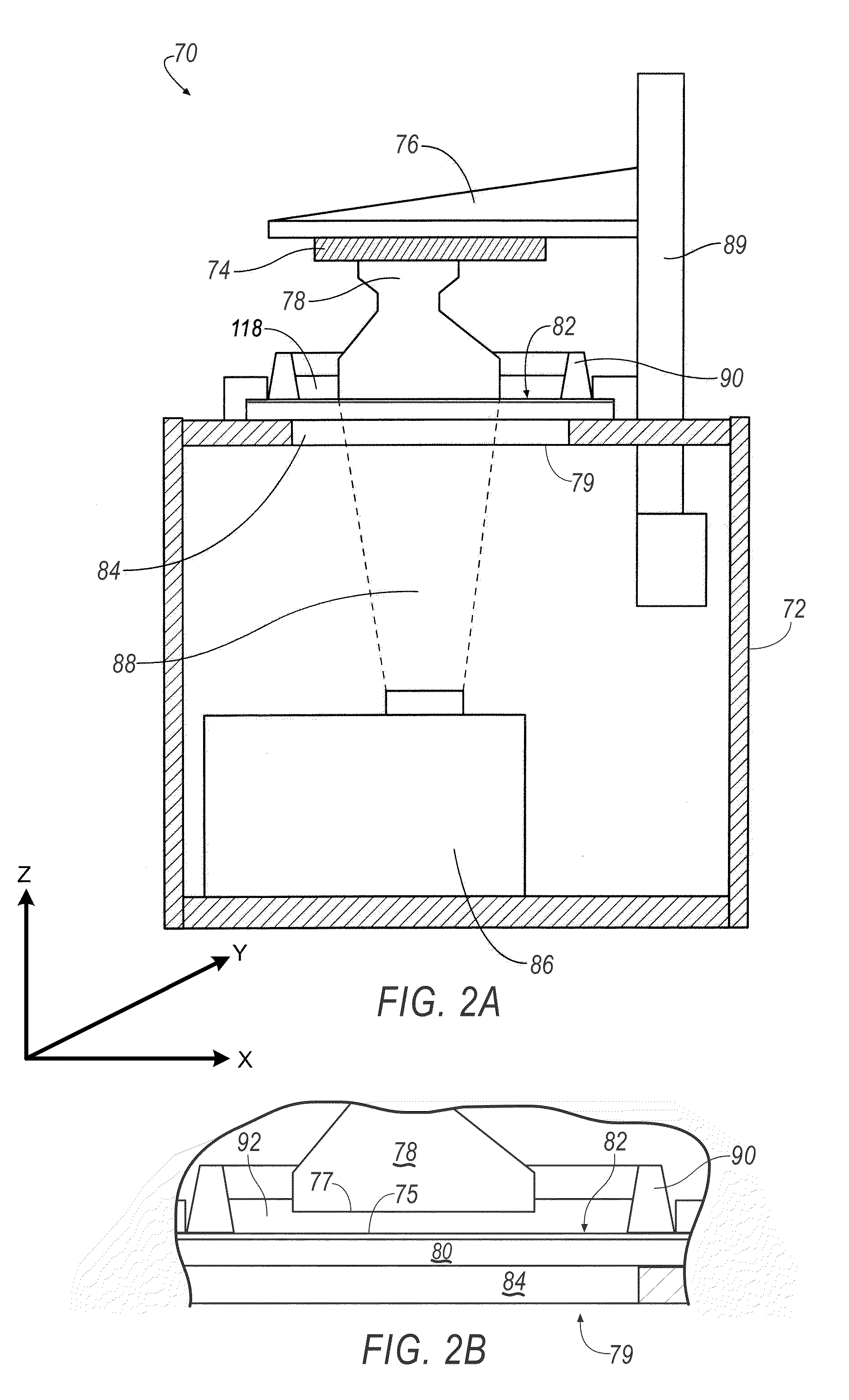

Method of reducing the force required to separate a solidified object from a substrate

A method and apparatus for making a three-dimensional object from a solidifiable material such as a photopolymer is shown and described. In accordance with the method, positions relative to a build axis are subdivided into first and second exposure data subsets, and the first and second exposure data subsets are solidified in alternating sequences to reduce the surface area of solidified material in contact with a solidification substrate.

Owner:GLOBAL FILTRATION SYST

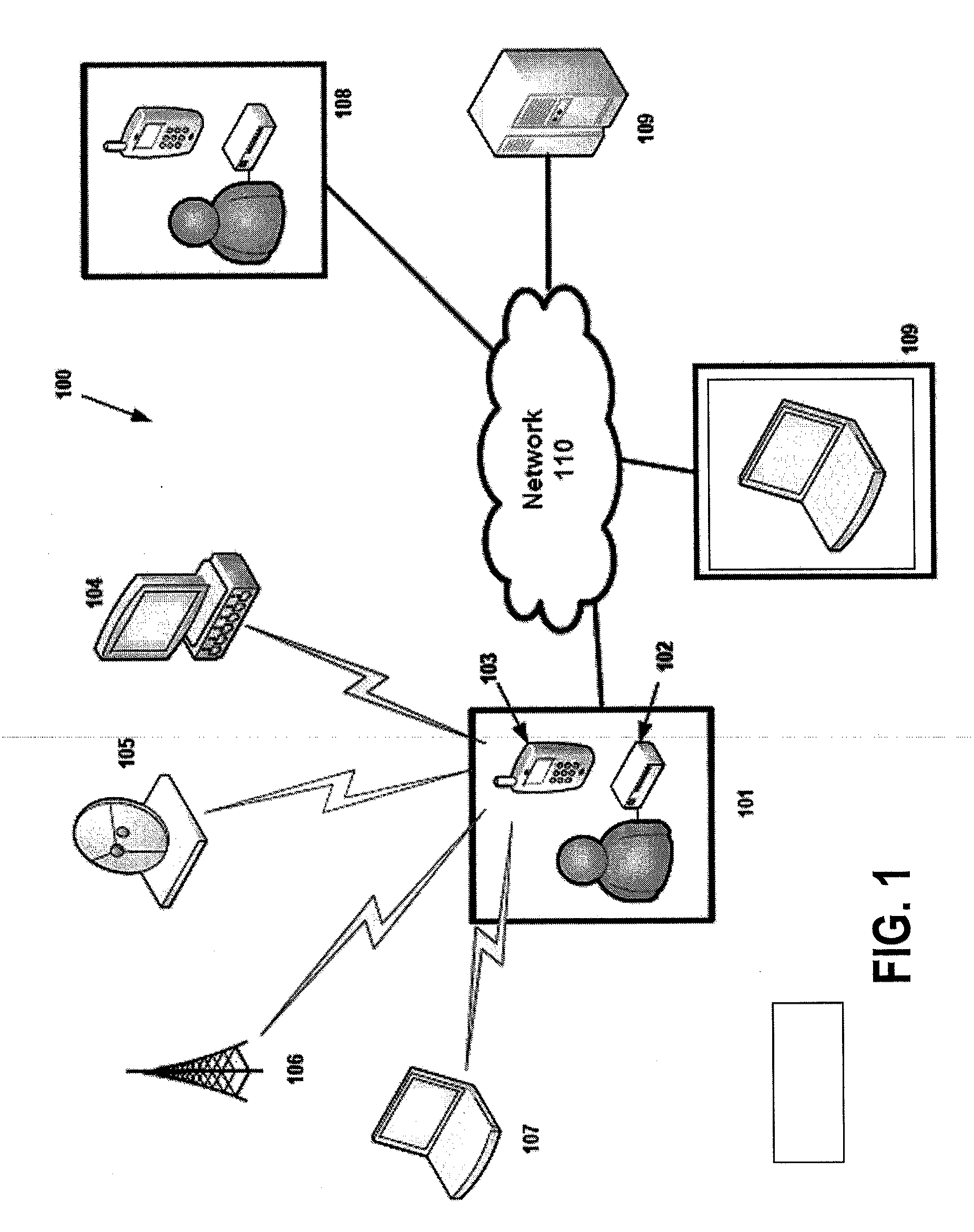

Apparatus, System and Methods for Portable Device Tracking Using Temporary Privileged Access

ActiveUS20140189095A1Specific access rightsDigital computer detailsComputer hardwareOperational system

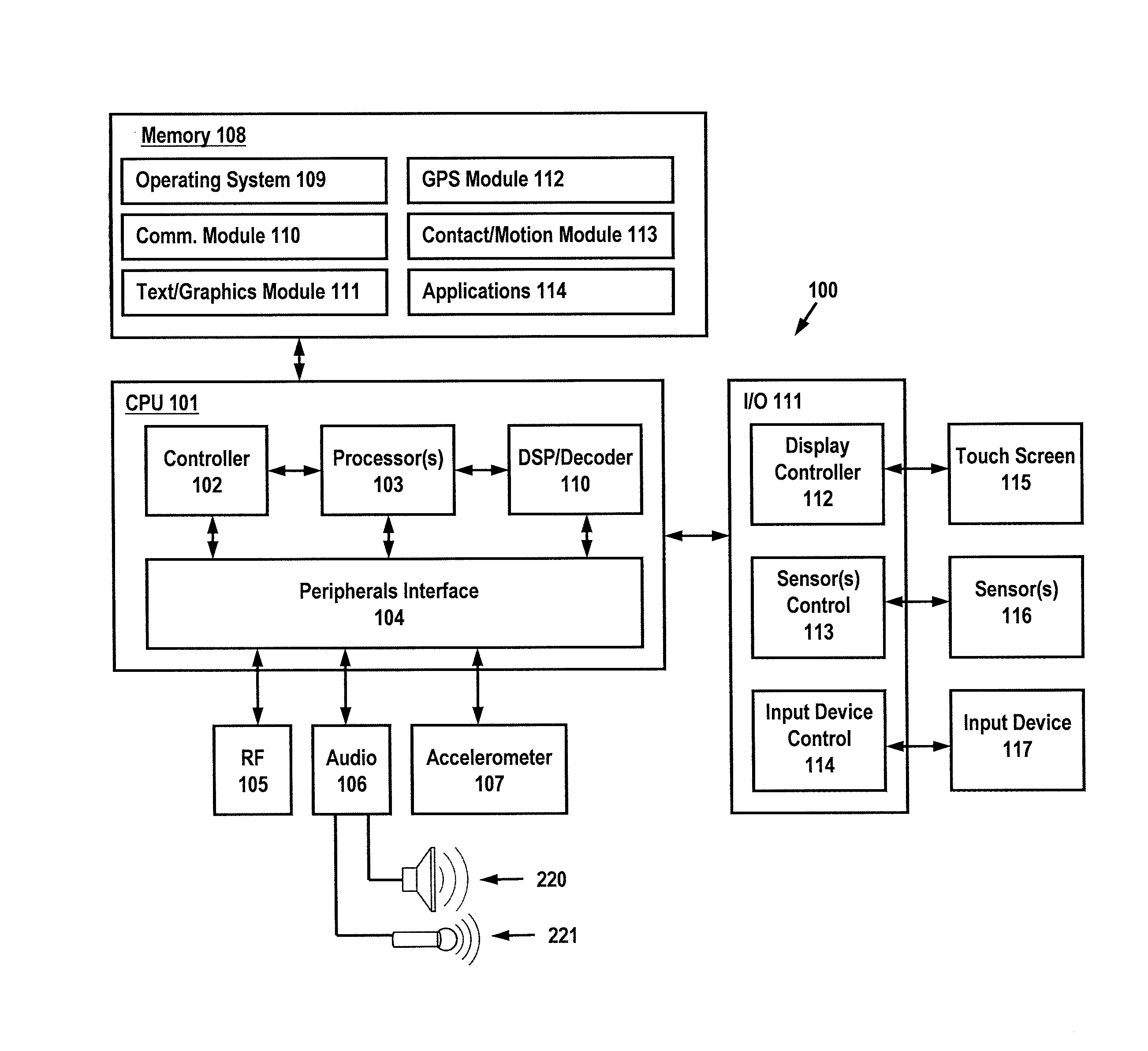

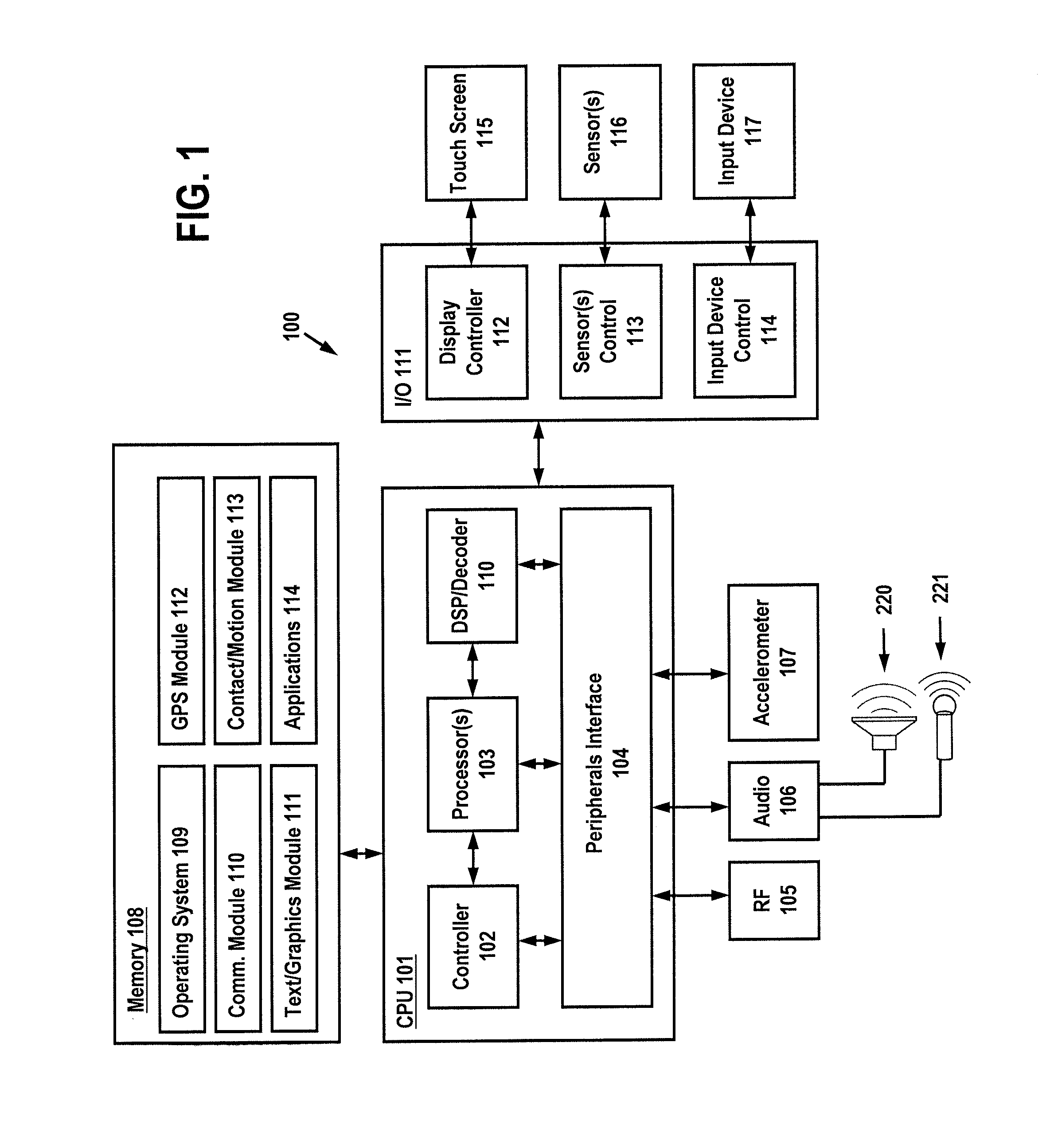

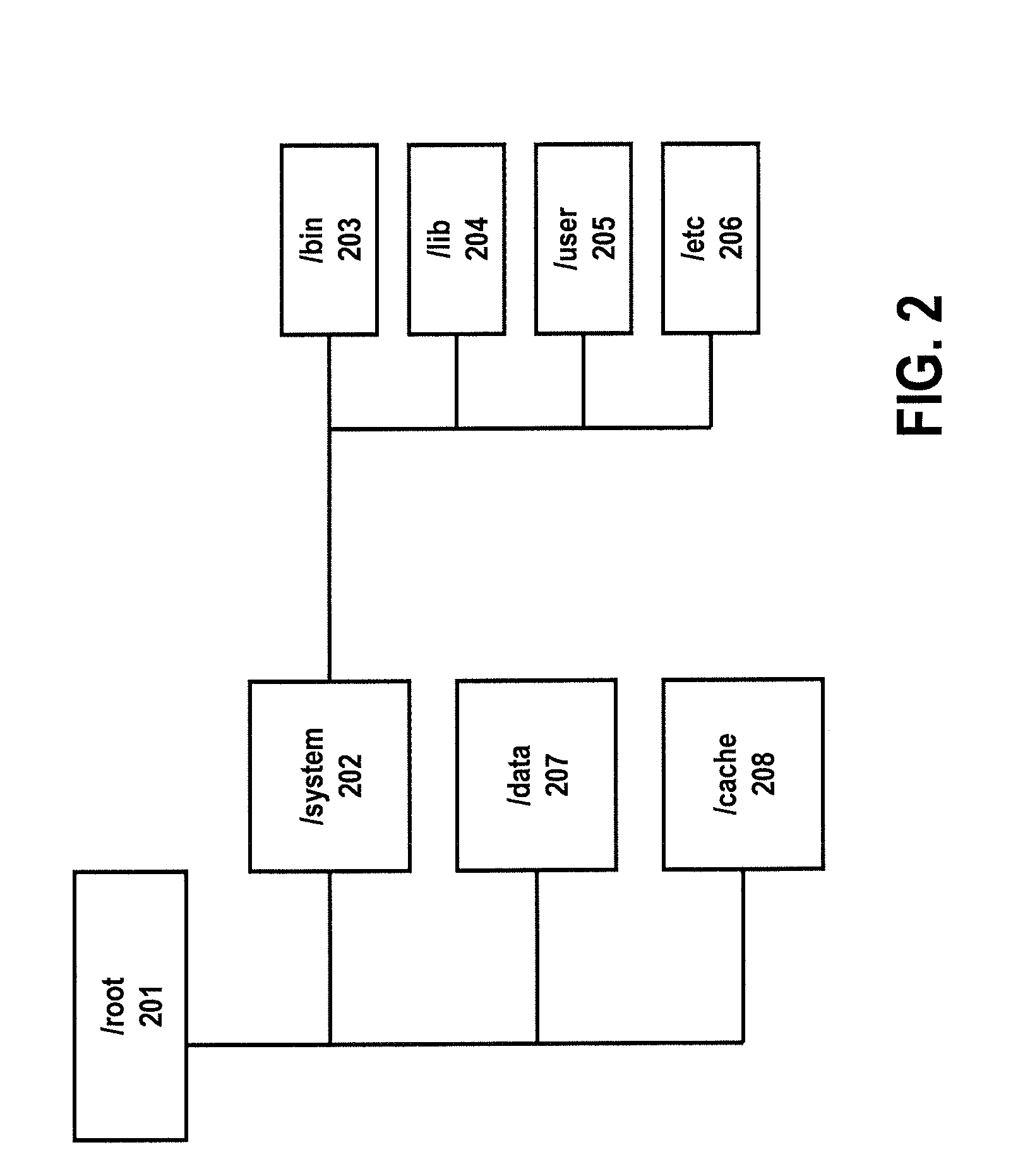

A computer-implemented system, apparatus and method for accessing a portable device to execute monitoring capabilities. The monitoring capabilities include packet detection, which in turn may be processed to produce media exposure data. The monitoring capabilities are installed using privileged access in order to obtain data from a kernel layer of the portable device, and the device is returned to an original state following installation, in order to comply with operating system requirements. Audio media exposure data may further be integrated with the packet-detected media exposure data.

Owner:THE NIELSEN CO (US) LLC

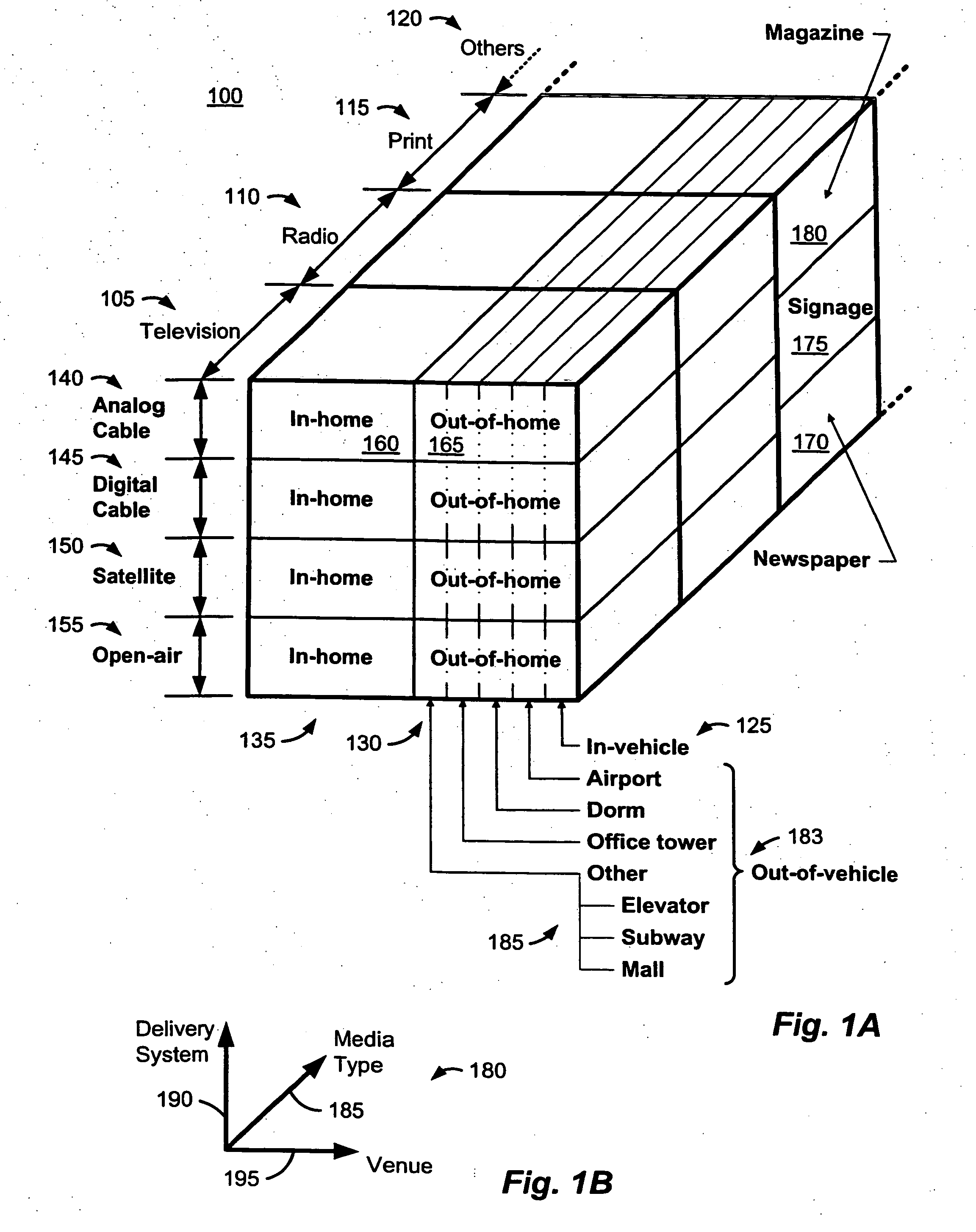

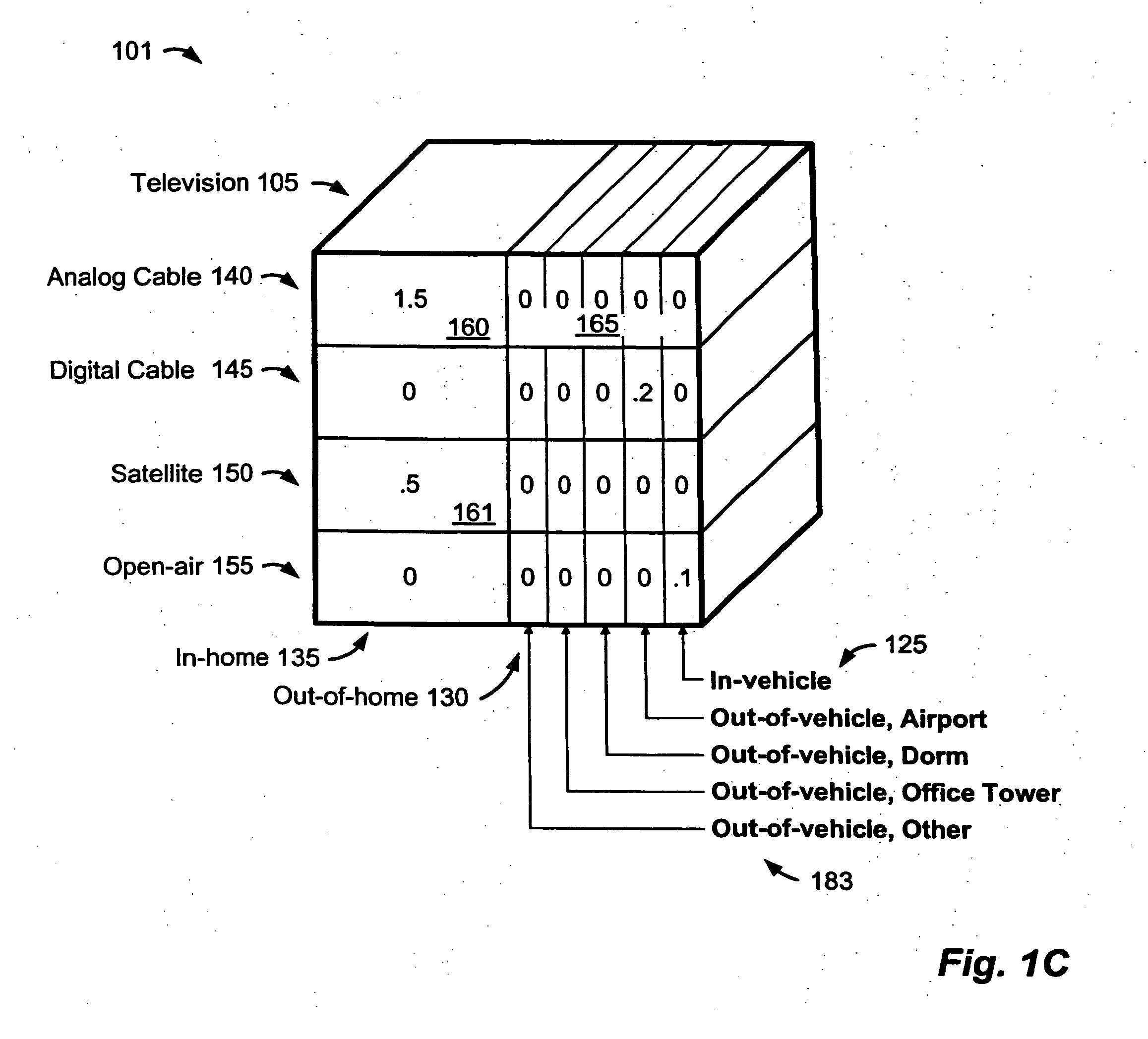

Method and system for characterizing audiences, including as venue and system targeted (VAST) ratings

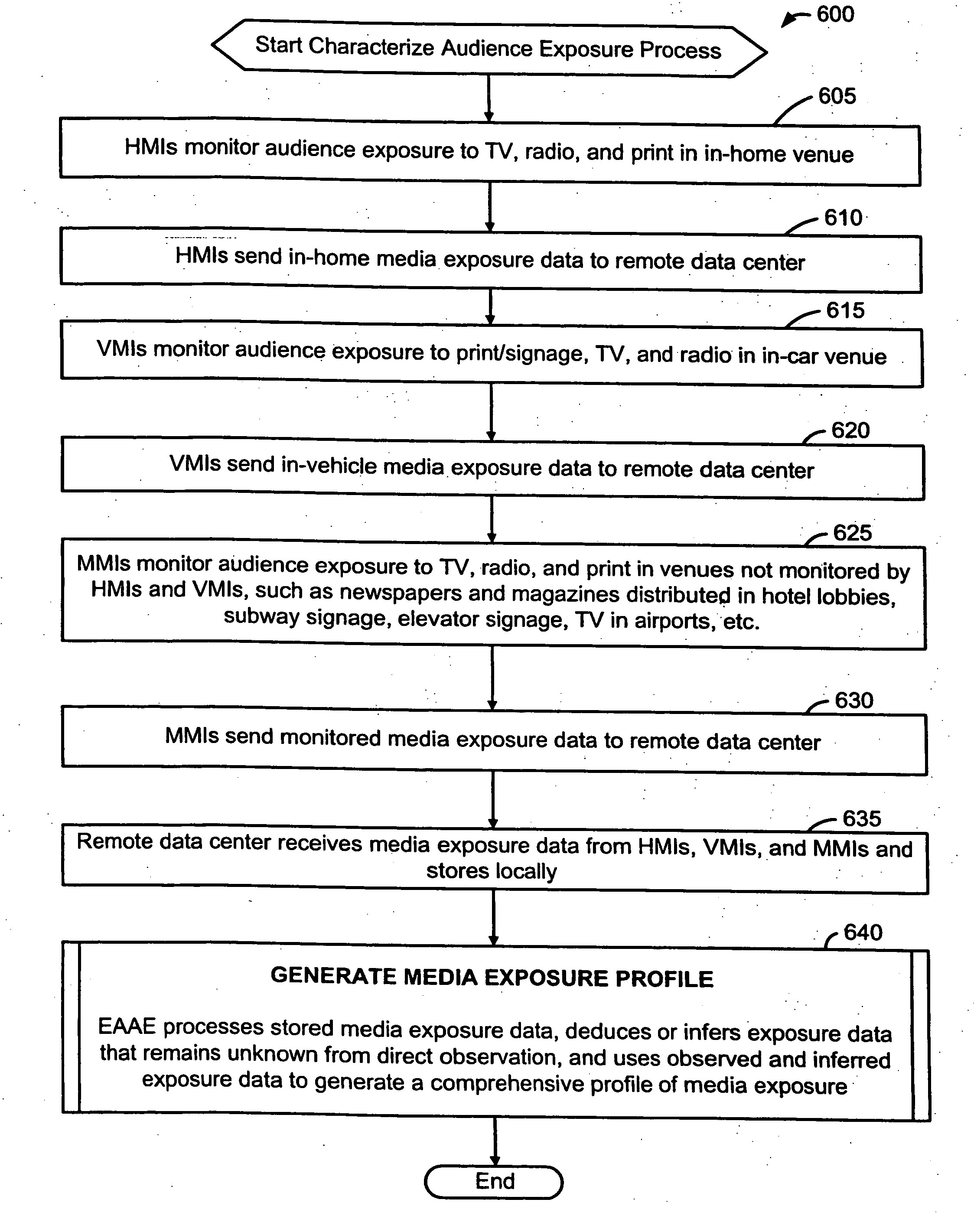

A system for characterizing an audience can comprise instruments that monitor representative audience members for media exposure and an engine that deduces information about the audience as a whole. A set of instruments can monitor each representative audience member's media exposure. An in-home instrument, such as a set top box or a hand-held remote control, can monitor exposure to in-home television and radio. An in-vehicle instrument can monitor billboard and onboard radio exposure. A manual instrument, such as a diary, can monitor other media exposure. The engine can process exposure data from the instruments for each monitored member to form a comprehensive media exposure profile of venue and system targeted (“VAST”) ratings. The profile can segment exposure according to delivery system, media type, and venue. The engine can extrapolate the data obtained for each monitored member to provide segmented exposure and demographic information about the audience as a whole.

Owner:MAGGIO FRANK S

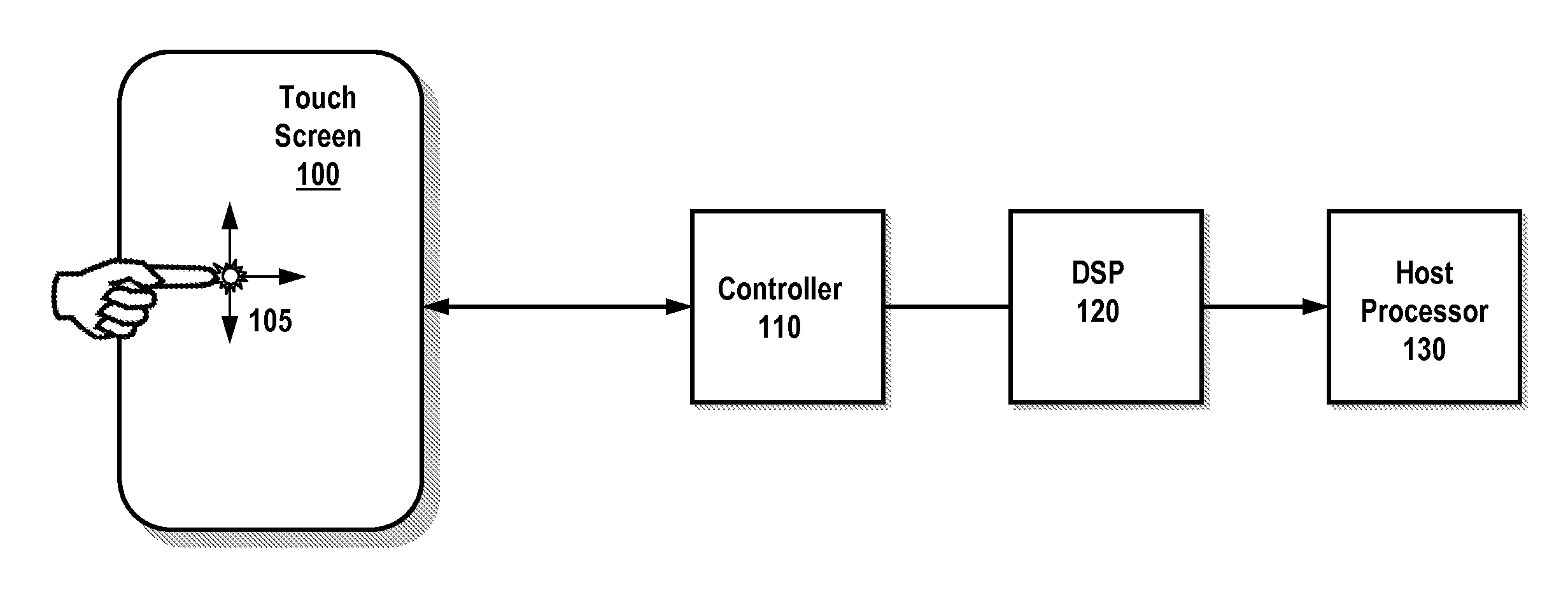

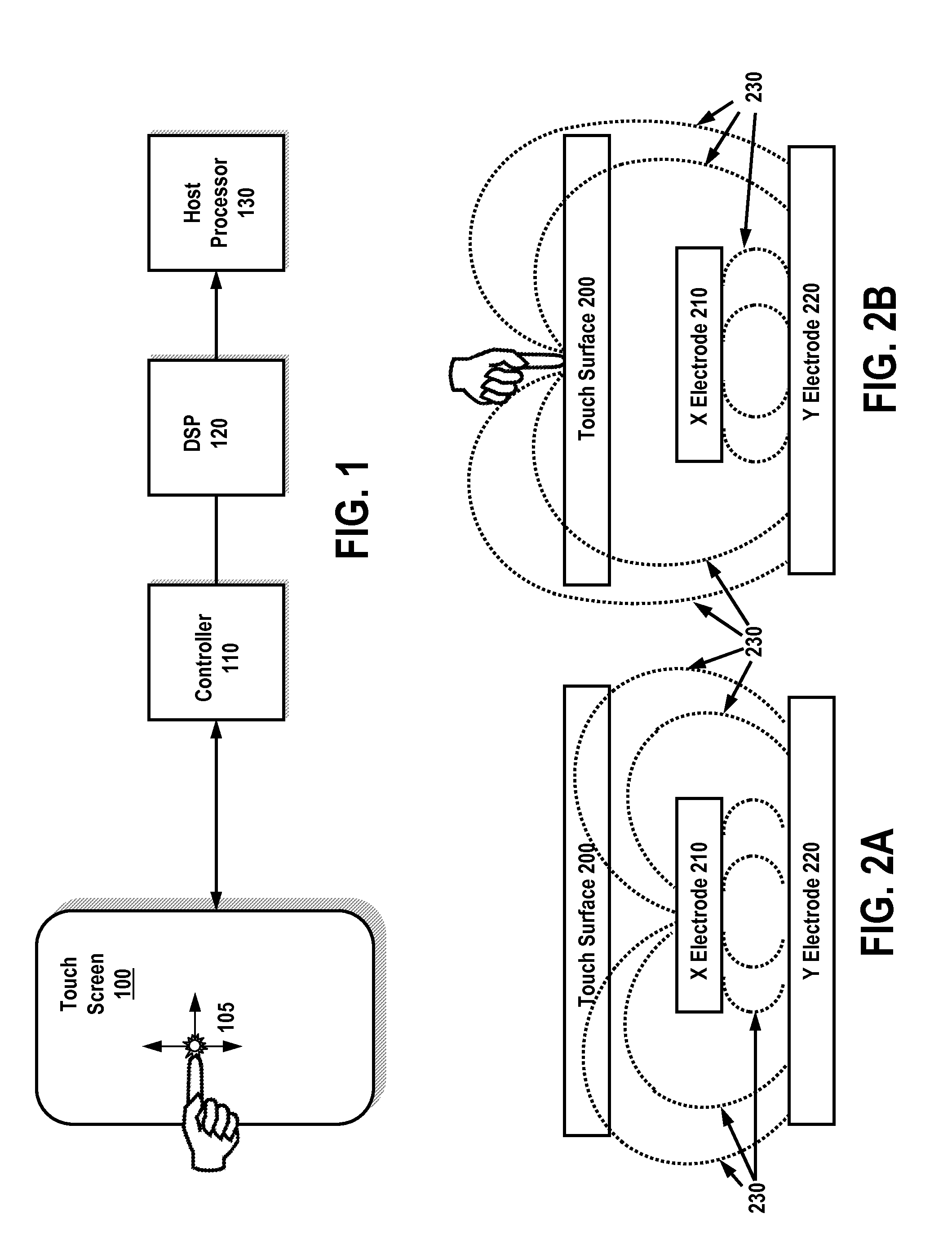

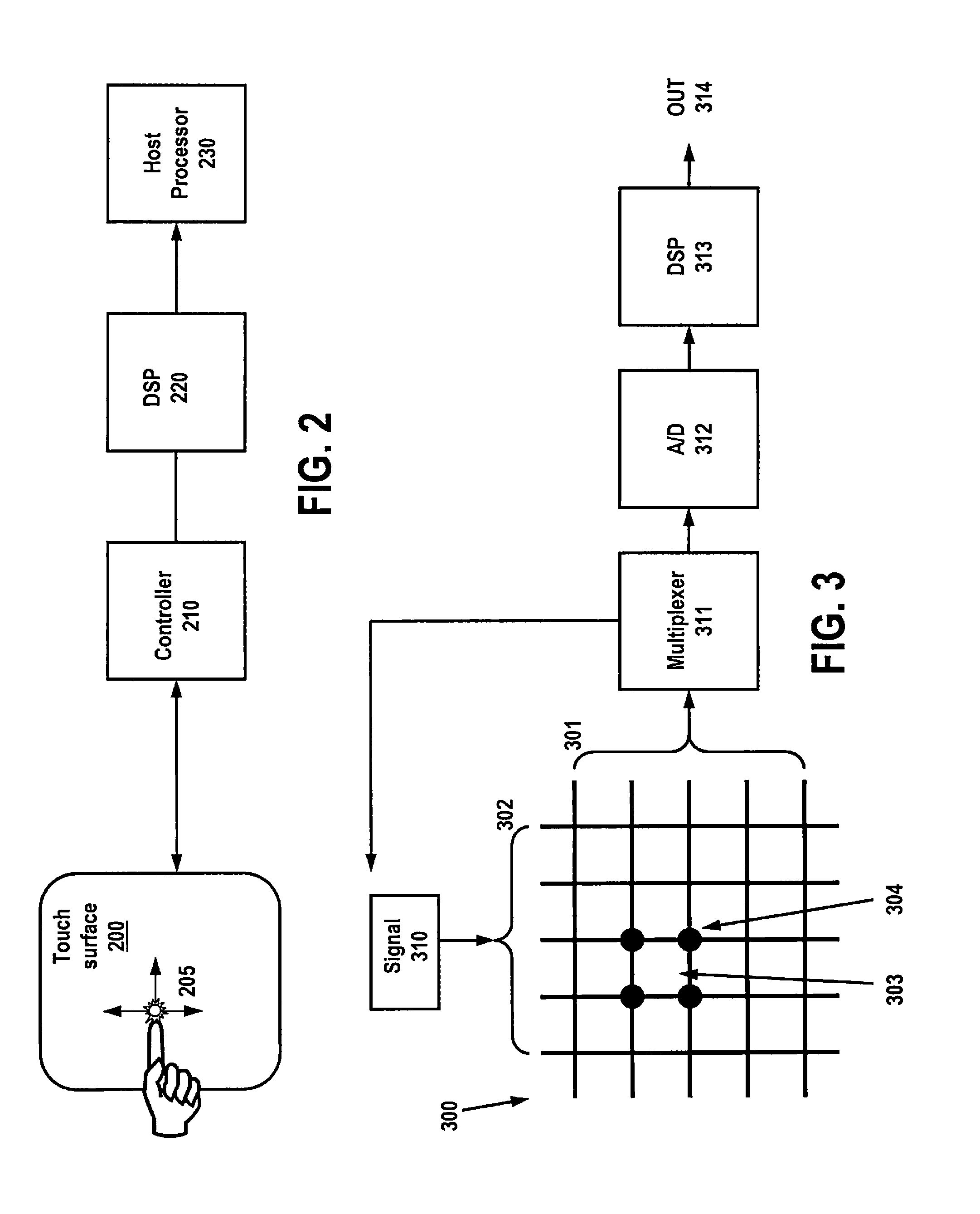

Tactile and gestational identification and linking to media consumption

InactiveUS20130135218A1Digital data authenticationInput/output processes for data processingRelevant informationTouchscreen

Systems and methods are disclosed for identifying users of touch screens according to a touch / gesture profile. The profile includes stored electrical characteristics of contact with the touch screen. The profile is correlated with applications opened and / or accessed, along with any associated metadata, as well as media exposure data derived from audio received at the device. The correlated information may be used to confirm identification of one or more individuals using a device for audience measurement purposes.

Owner:THE NIELSEN CO (US) LLC

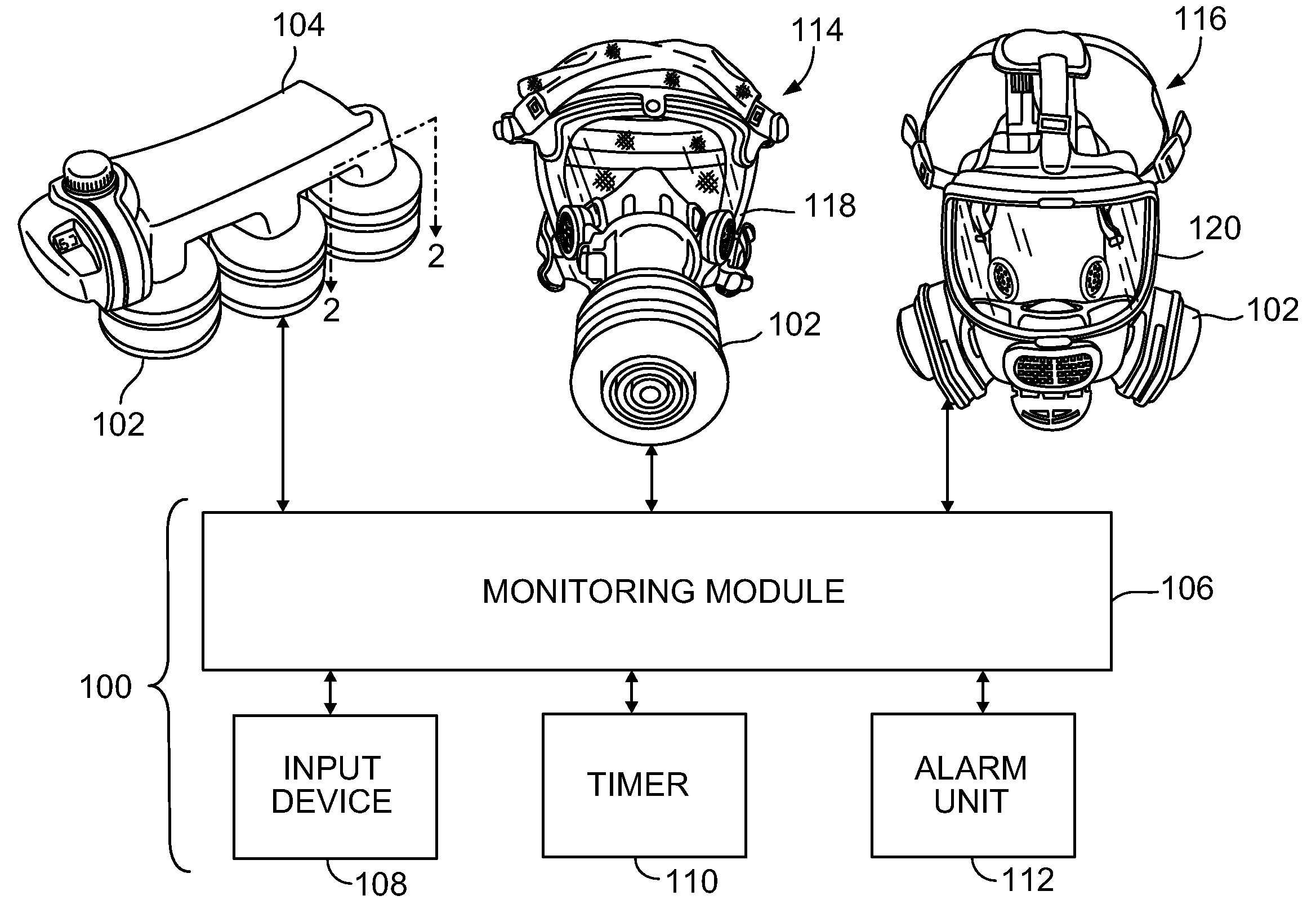

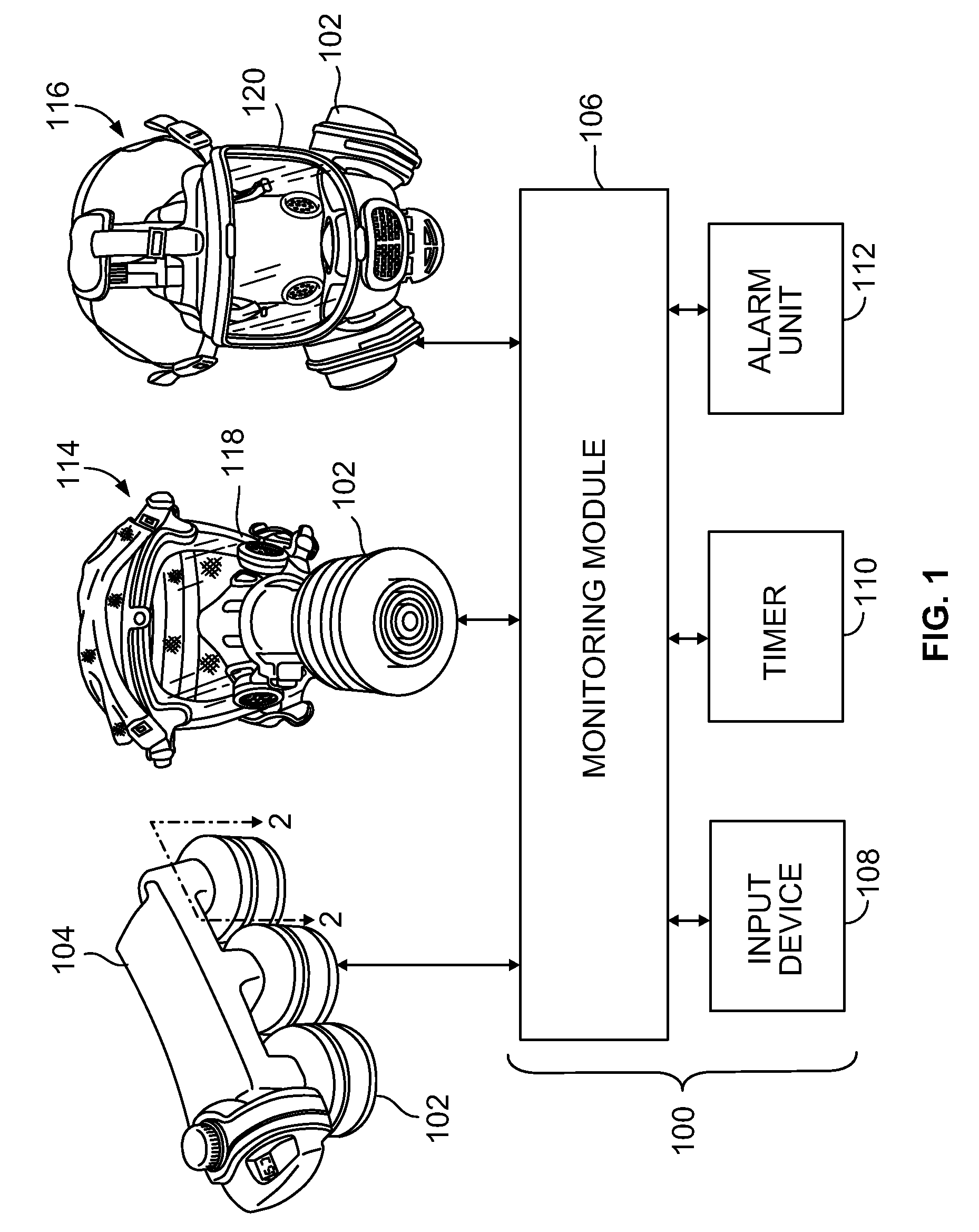

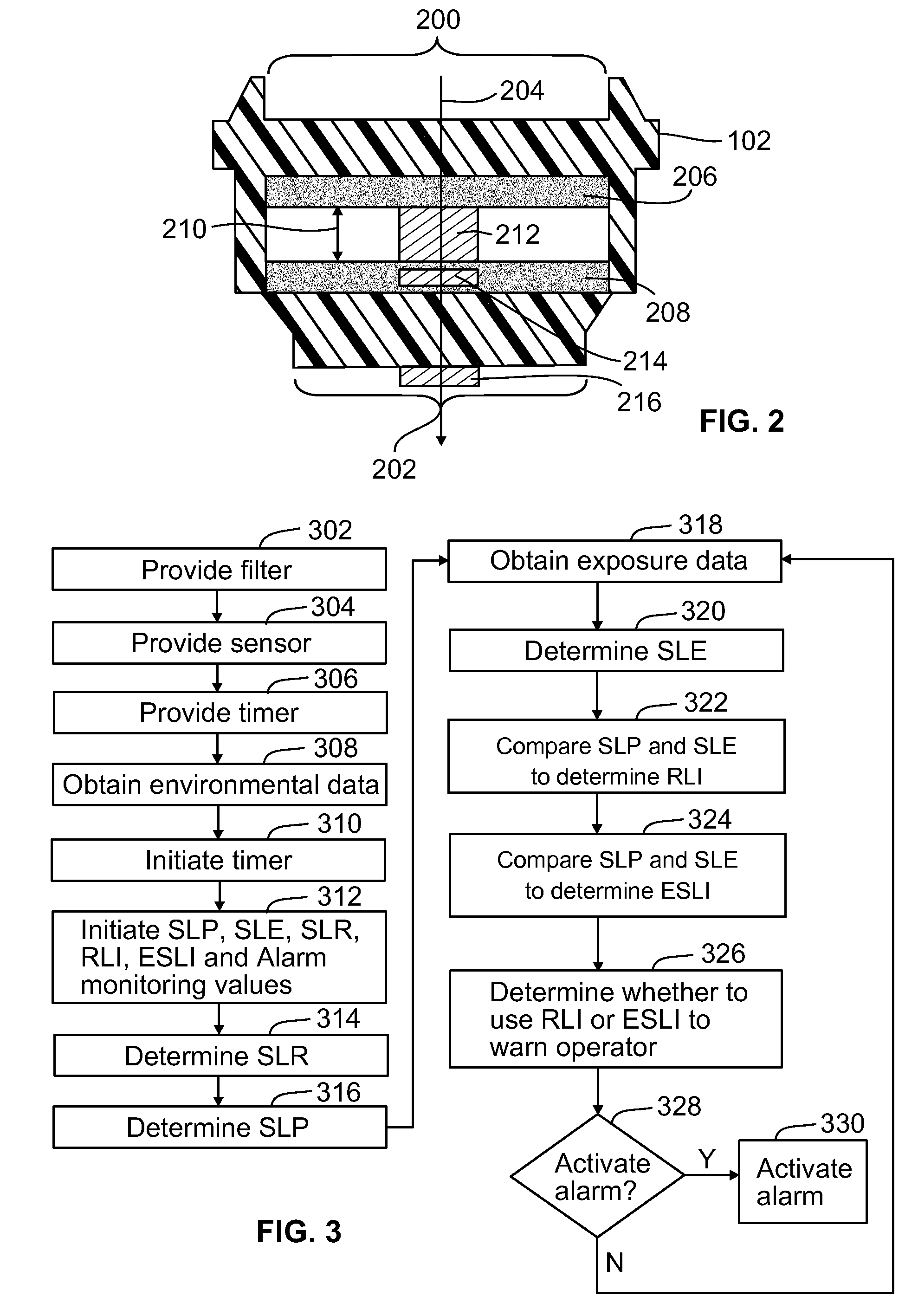

Systems and methods for determining filter service lives

A method for determining a service life for a filter includes measuring exposure data and calculating a service life estimate based on the exposure data. The service life estimate is representative of an estimated exposure time that the filter is exposed to ambient conditions represented by the exposure data before the contaminant passes through the filter at a breakthrough concentration. The method also includes obtaining environmental data and establishing a predicted service life based on the environmental data. The predicted service life is representative of a predicted exposure time that the filter is exposed to the ambient conditions represented by the environmental data before the contaminant passes through the filter at the breakthrough concentration. The method further includes determining the service life for the filter based on a comparison of the estimated and predicted service lives.

Owner:SCOTT TECH INC

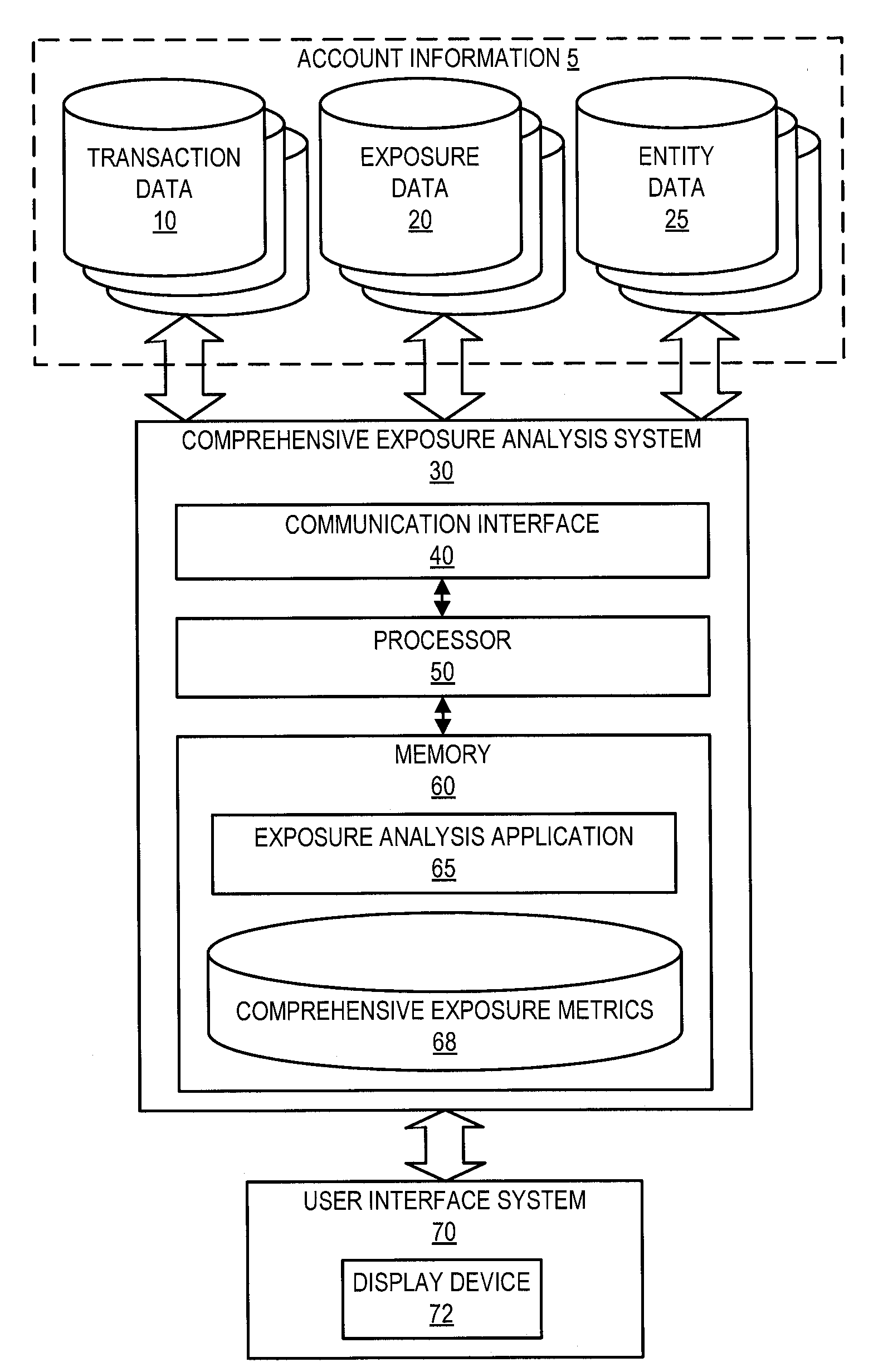

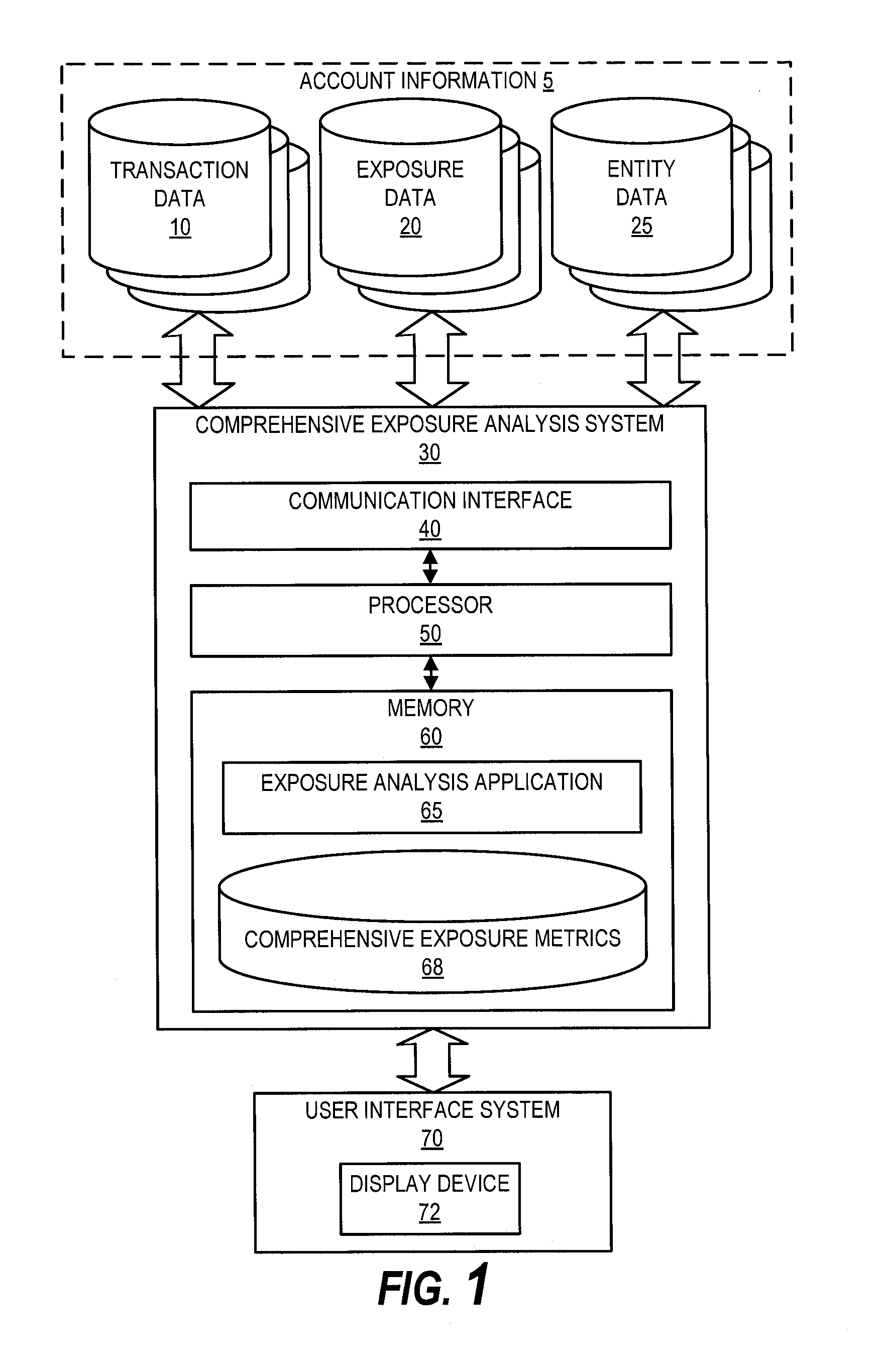

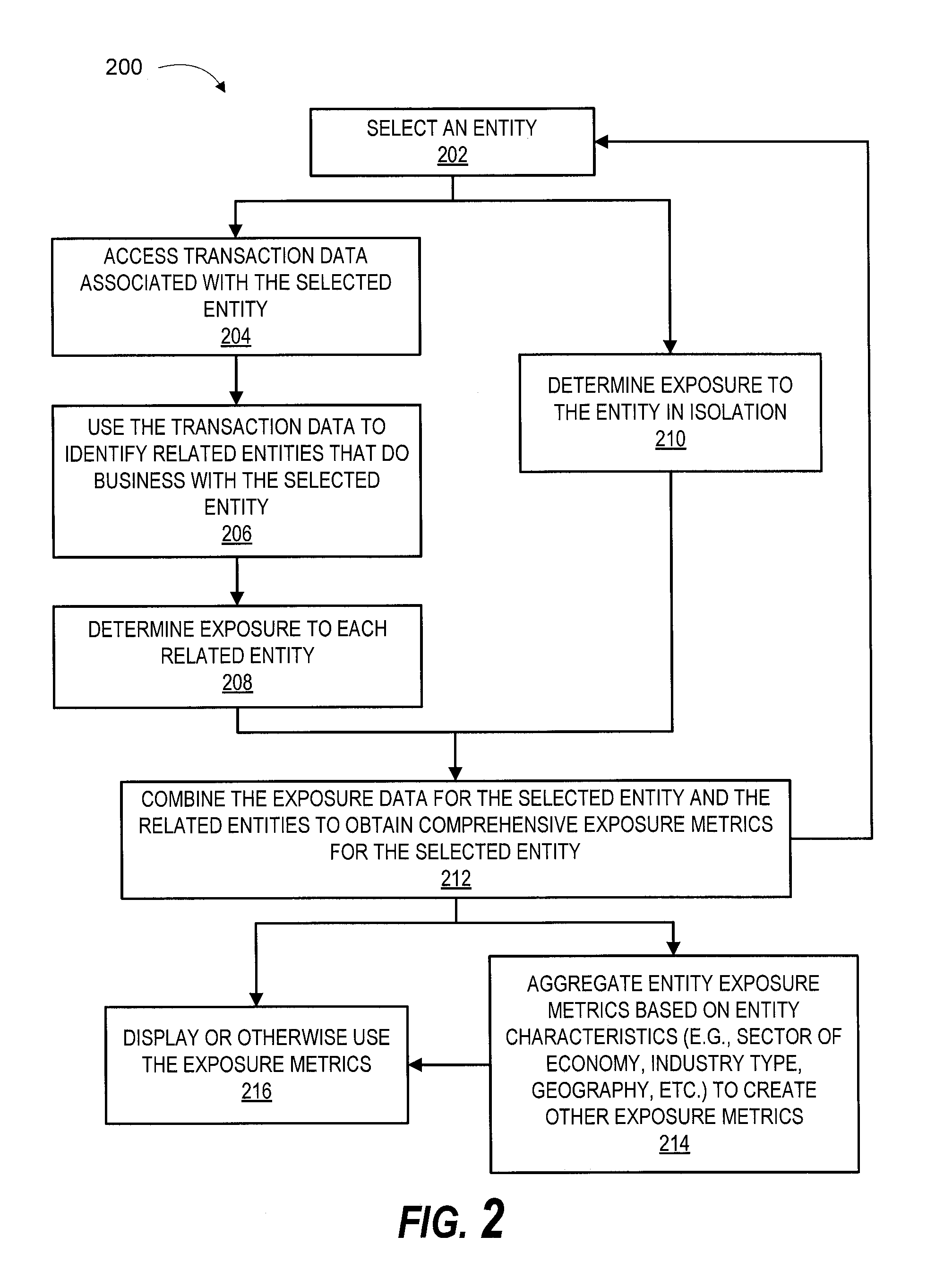

Comprehensive exposure analysis system and method

Embodiments of the invention allow an institution to obtain a more comprehensive view of its exposure to one or more entities or groups of entities and, in some cases, to use this information to identify opportunities for and / or risks to the institution. For example, embodiments of the invention involve systems and methods for: (1) selecting an entity; (2) determining exposure to the entity in isolation; (3) determining one or more related entities based on transaction data associated with the selected entity; (4) determining exposure to the one or more related entities; and (5) combining the exposure data for the selected entity and the related entities to obtain comprehensive exposure metrics for the selected entity. Some embodiments of the invention further involve aggregating the comprehensive entity exposure metrics for several entities based on entity characteristics to create other exposure metrics, and then displaying exposure metrics to a user on a display based on user-selected entities or entity characteristics.

Owner:BANK OF AMERICA CORP

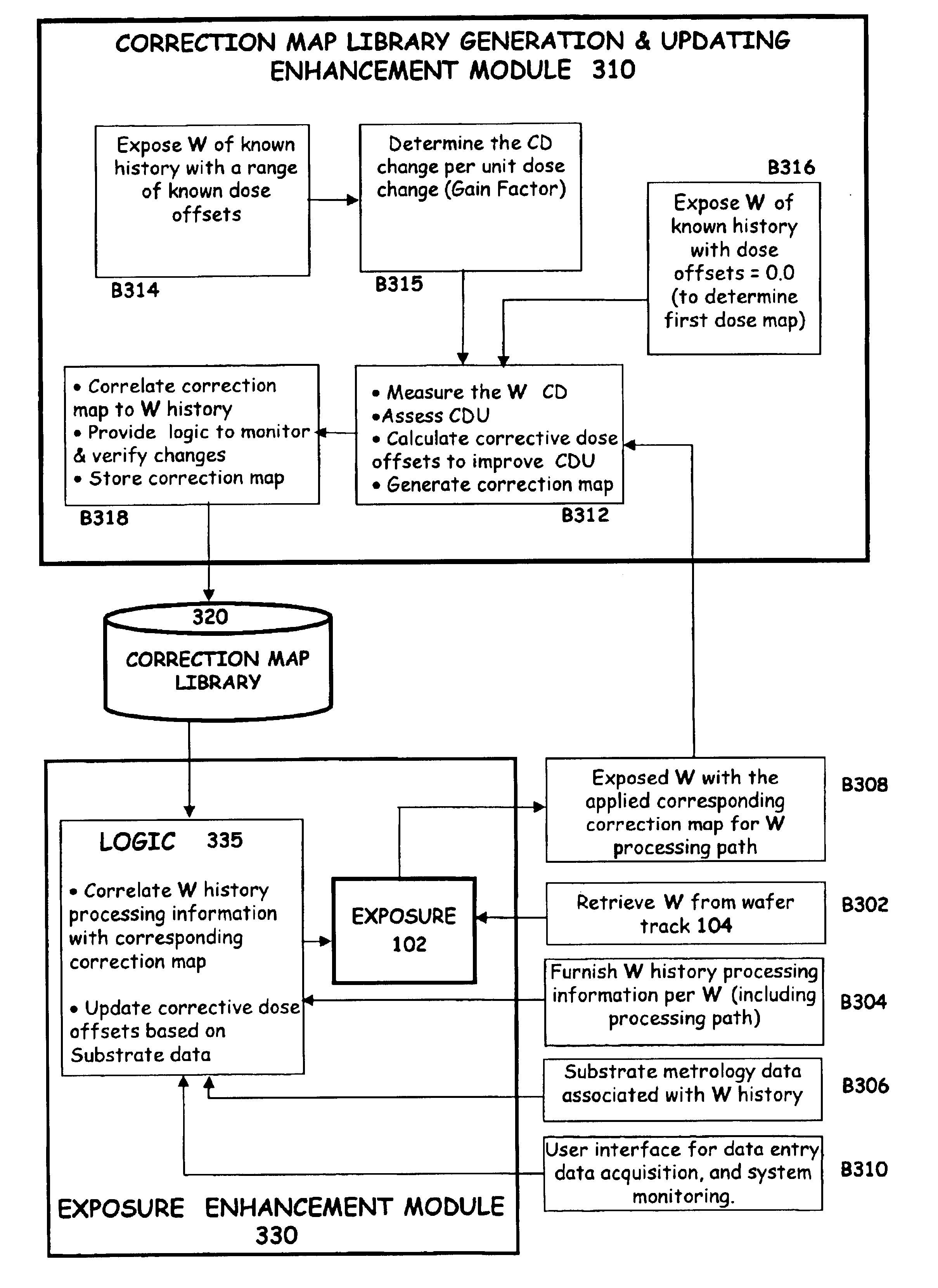

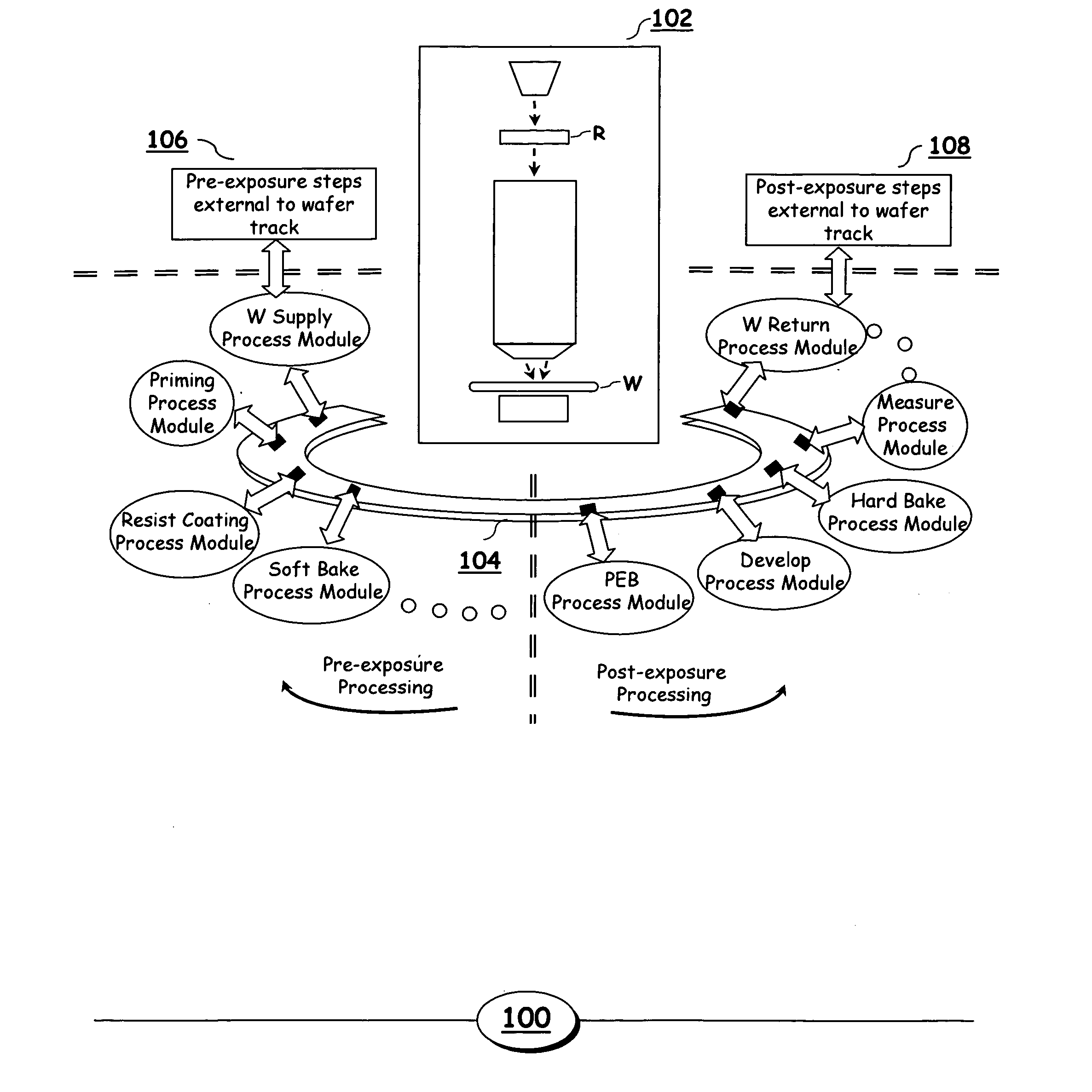

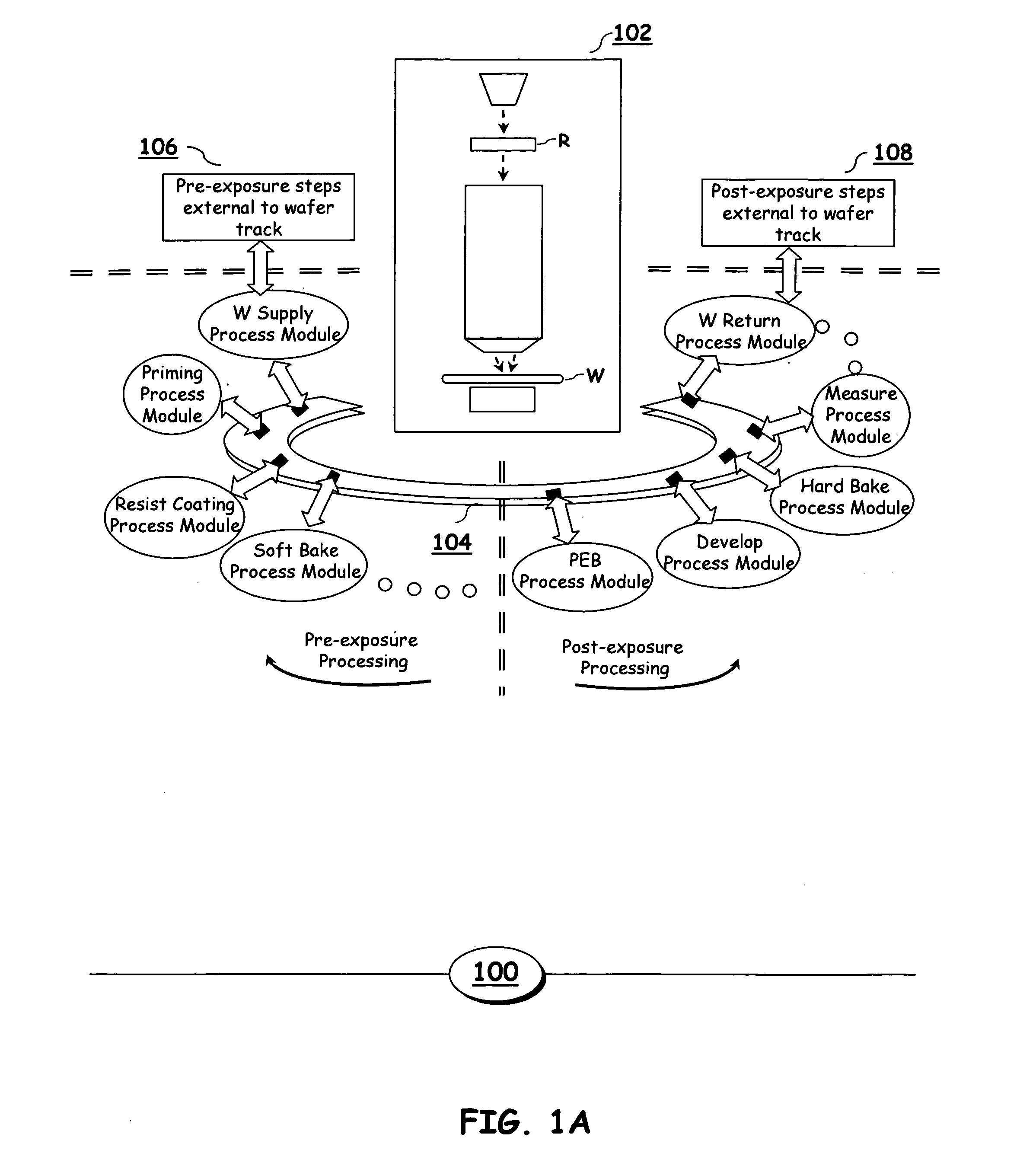

Adaptive lithographic critical dimension enhancement

ActiveUS6873938B1Improved CD uniformityNon-uniformities can be correctedResistance/reactance/impedenceError detection/correctionEngineeringCritical dimension

Owner:ASML NETHERLANDS BV

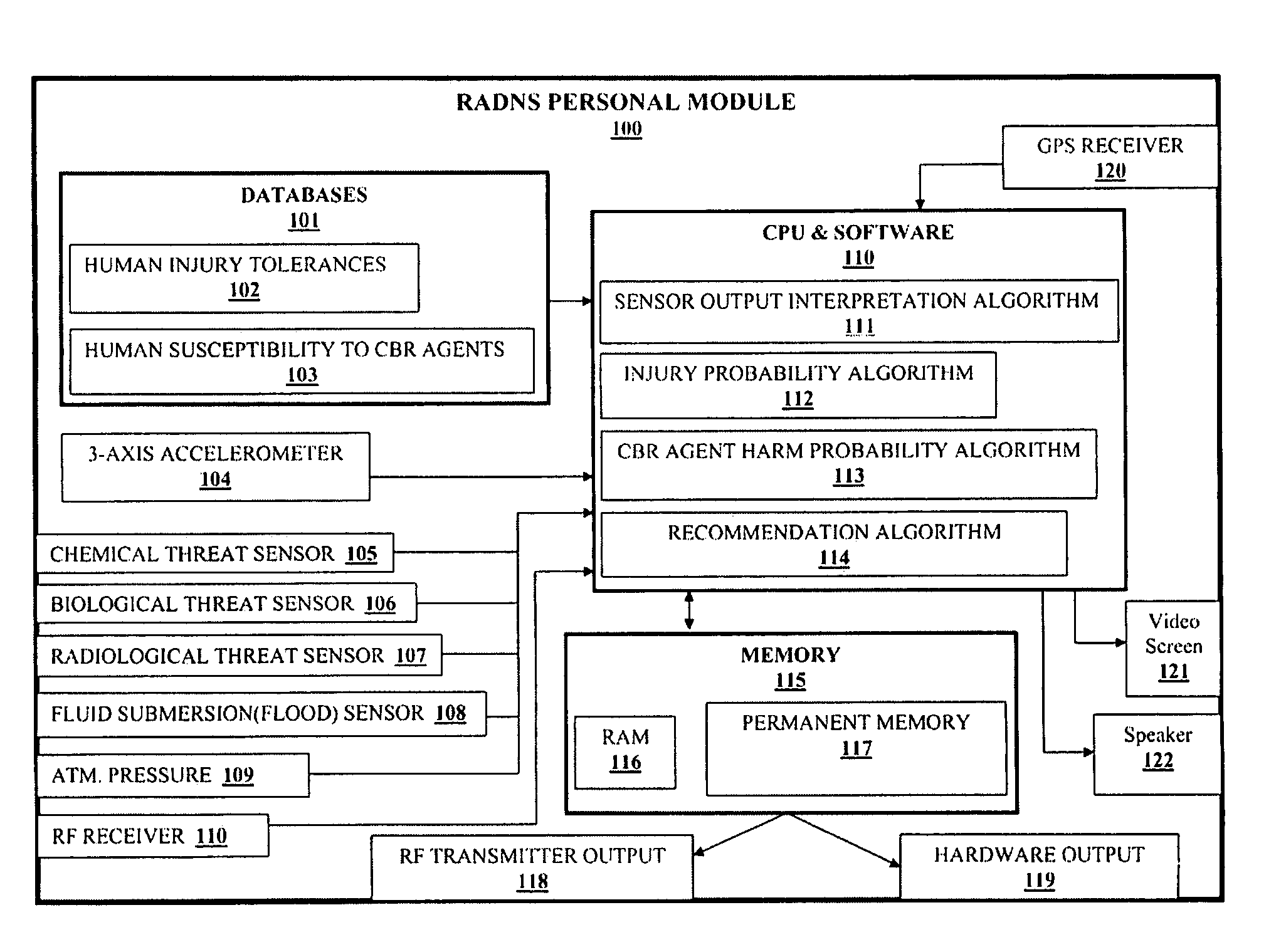

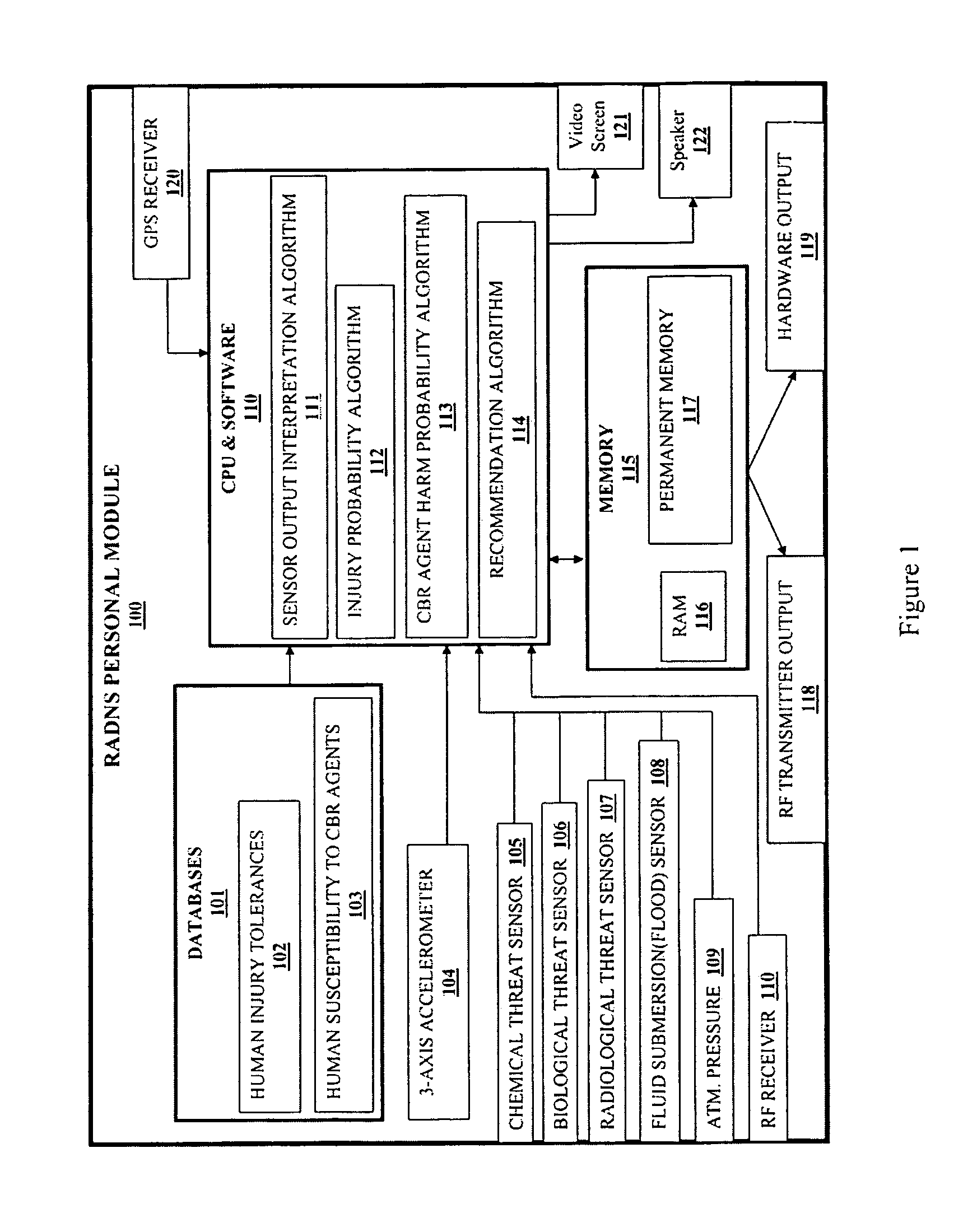

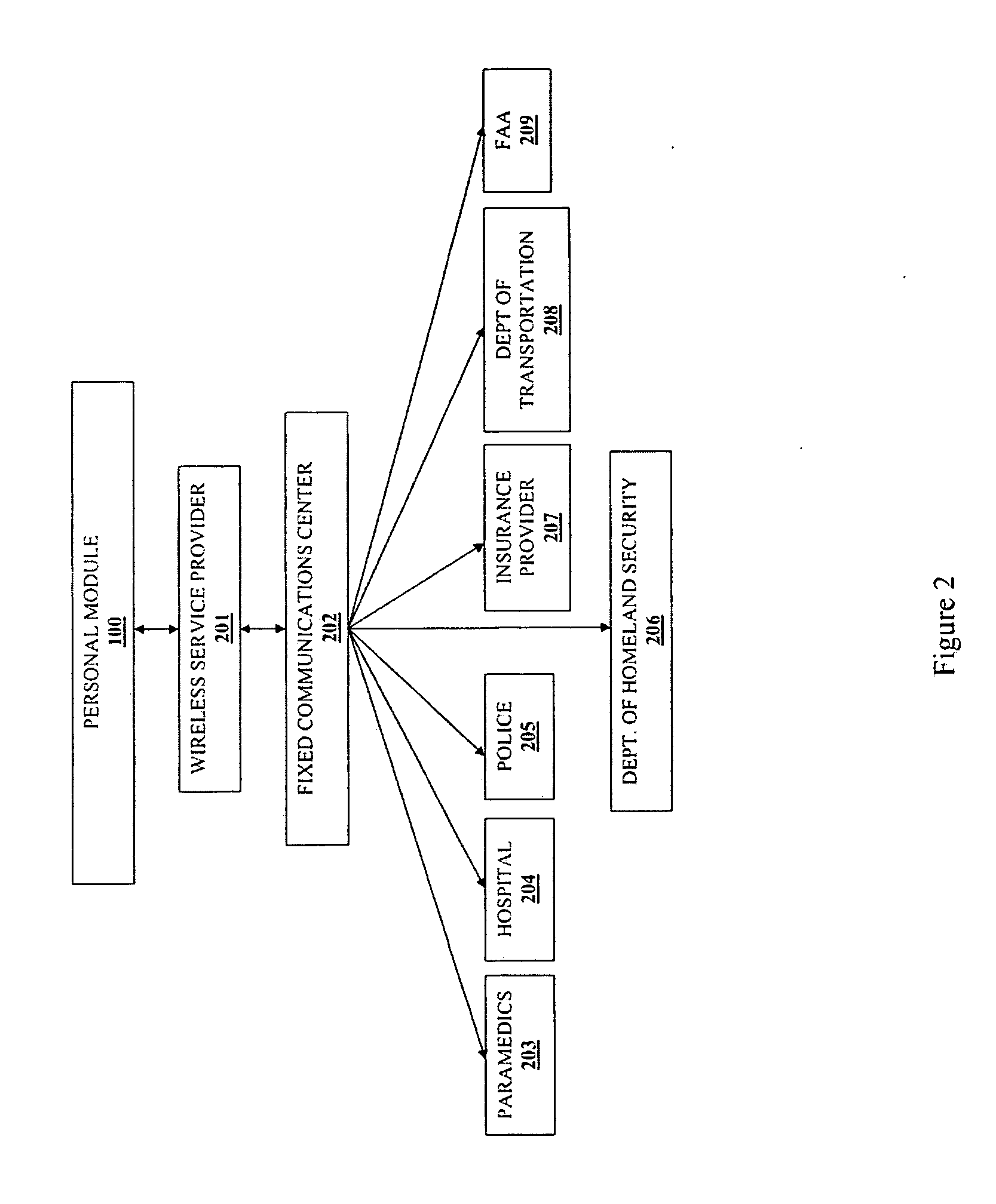

Rapid disaster notification system

InactiveUS20080088434A1Remove restrictionsQuickly and efficiently transmit useful informationAlarmsElectric signalling detailsField conditionsEngineering

A system operable for detecting the exposure of a person or persons to a plurality of different hazards. The system comprises at least one wearable personal module, a fixed communication center and wireless linking means operable for providing wireless communication between a personal module and the communication center and between a personal module and other personal modules comprising the system. The personal module is operable for detecting exposure of the wearer to a hazard and includes computer means operable for evaluating the threat level of the hazard to the wearer. The personal module further includes telemetry means operable for communicating the threat level to the fixed communication center and / or other personal modules. The personal module includes a plurality of detectors operable for detecting the exposure of the wearer to one or more chemical, physical, biological or radiological hazards under field conditions. The fixed communication center is operable for receiving exposure data from one or more personal modules and communicating the exposure data to first responders.

Owner:SAFETY DESIGN ANANYSIS

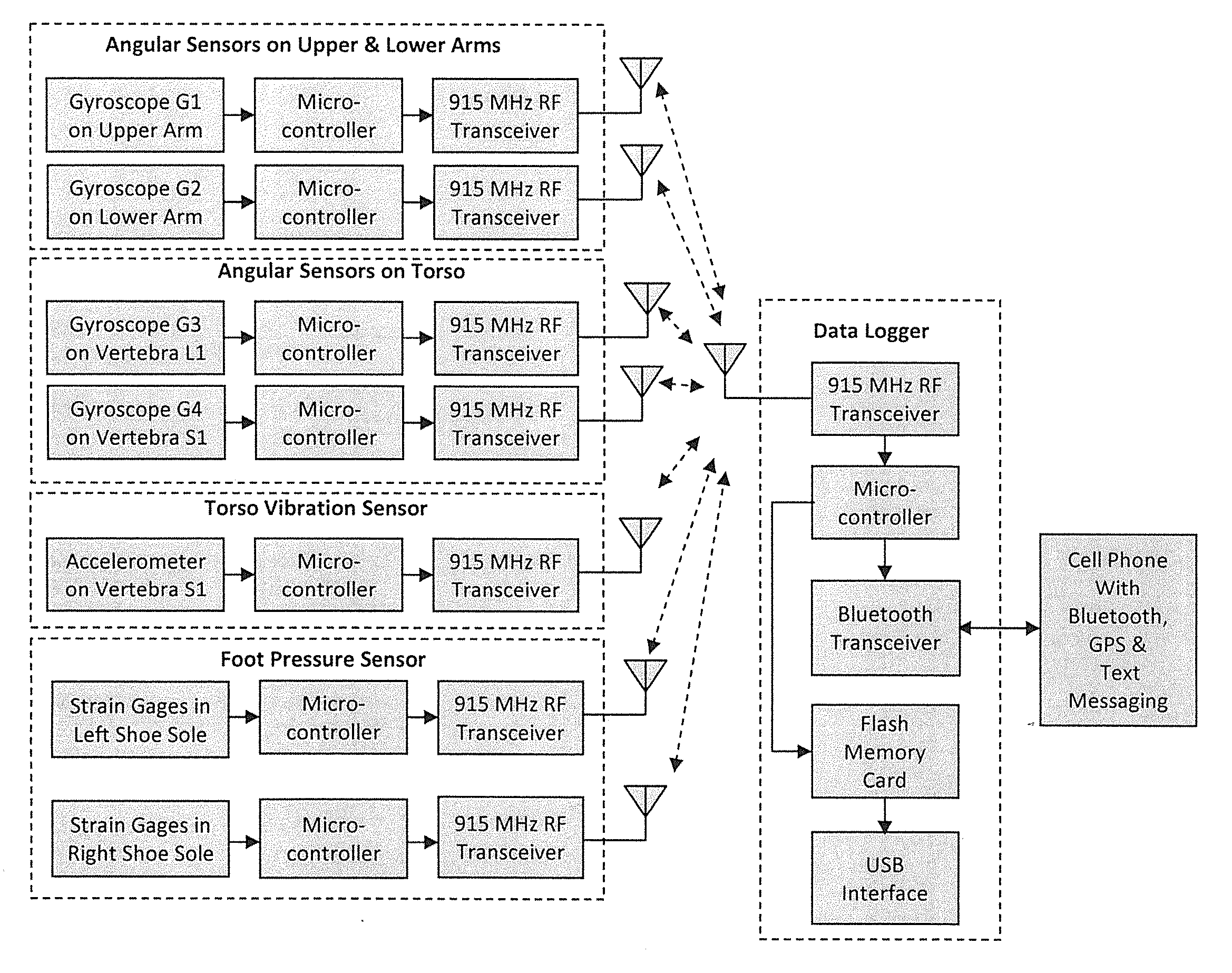

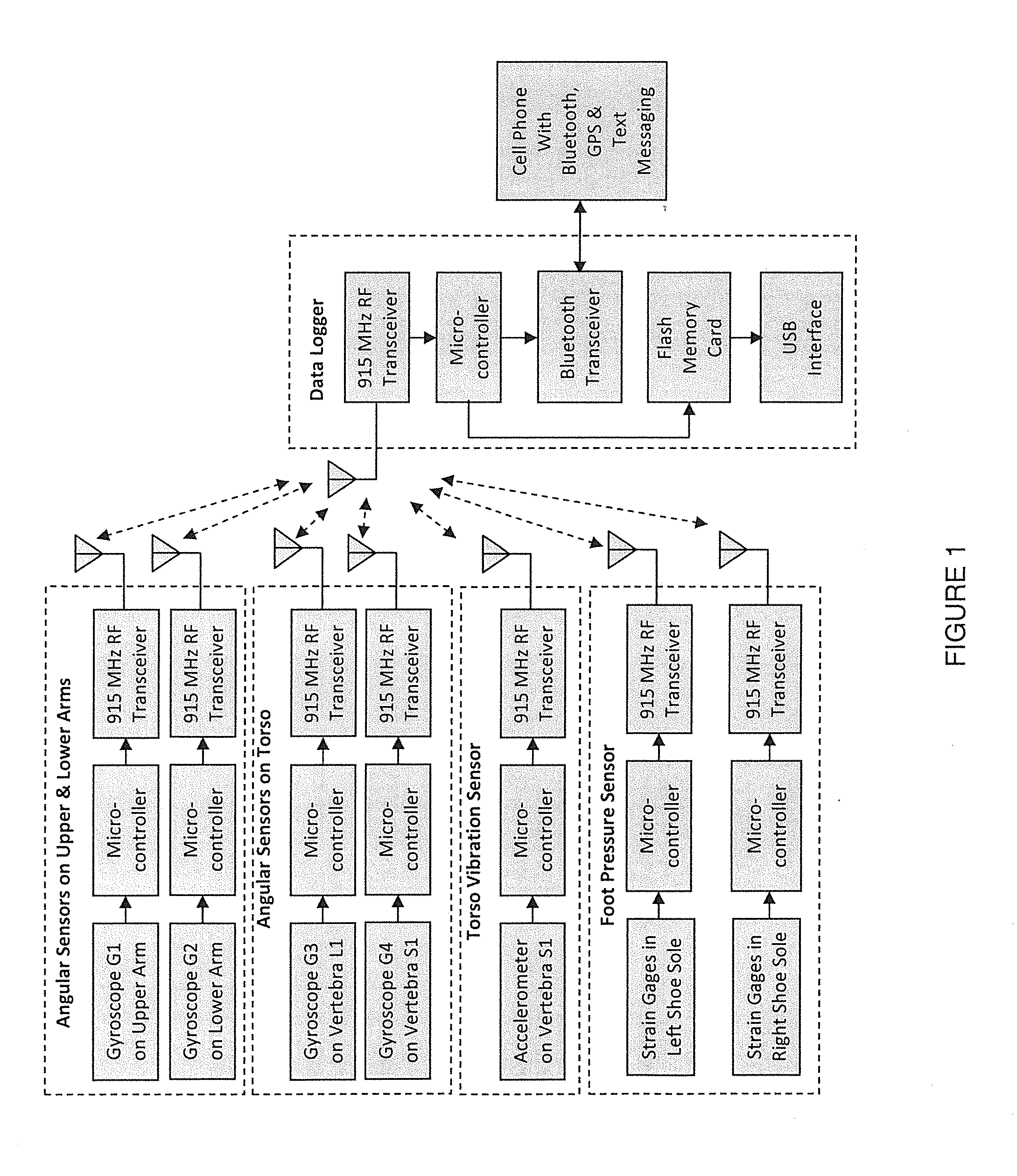

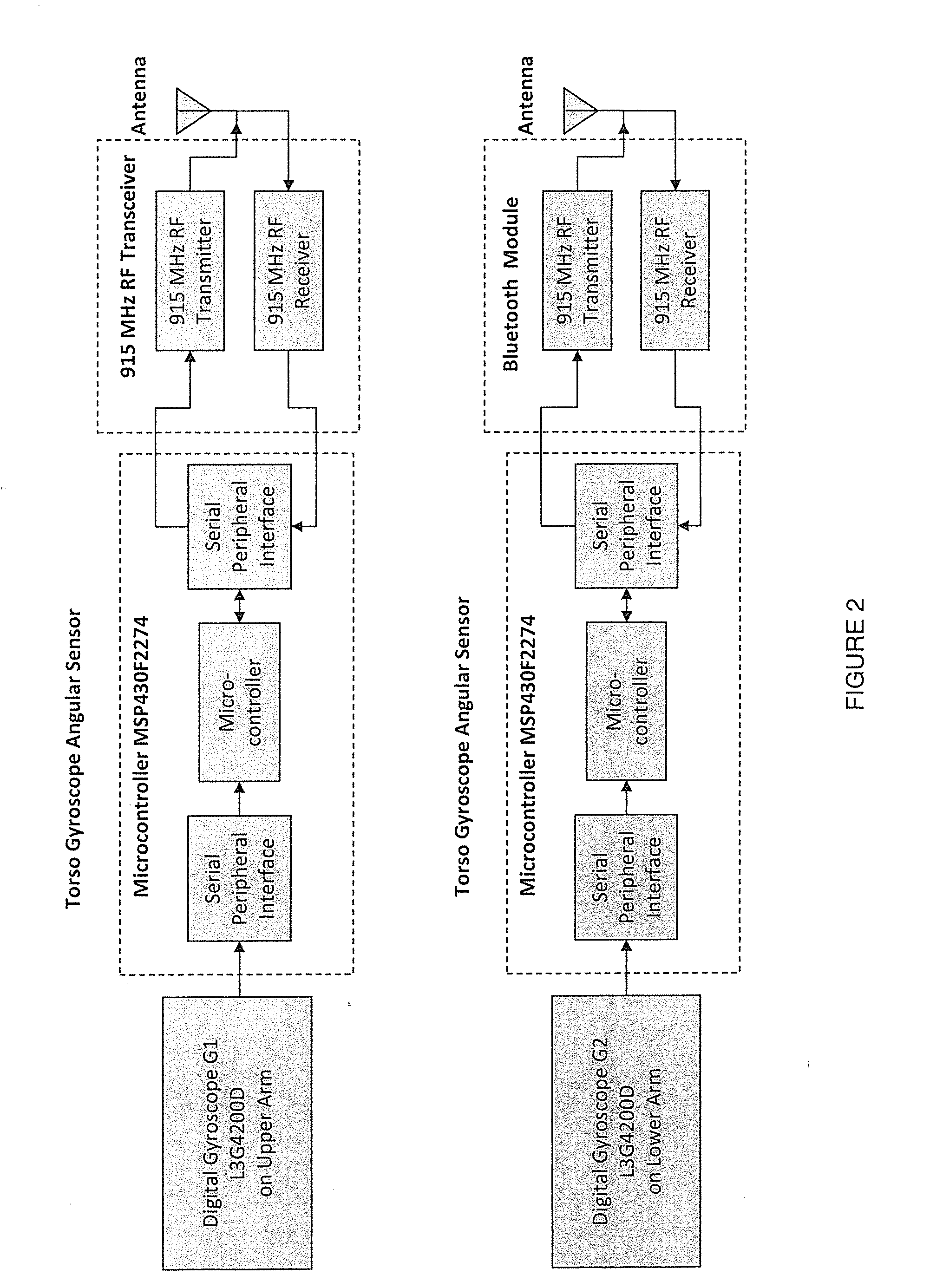

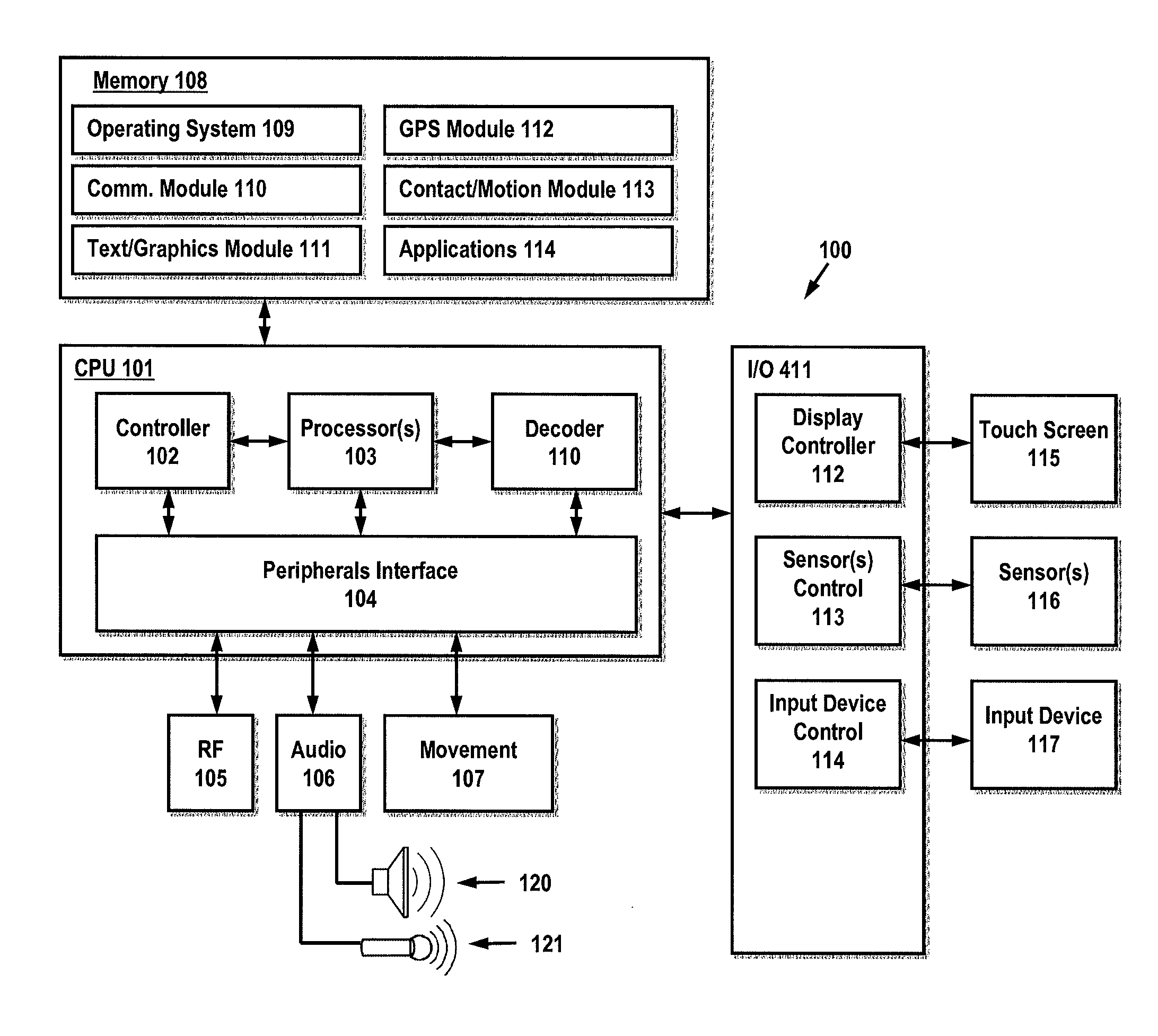

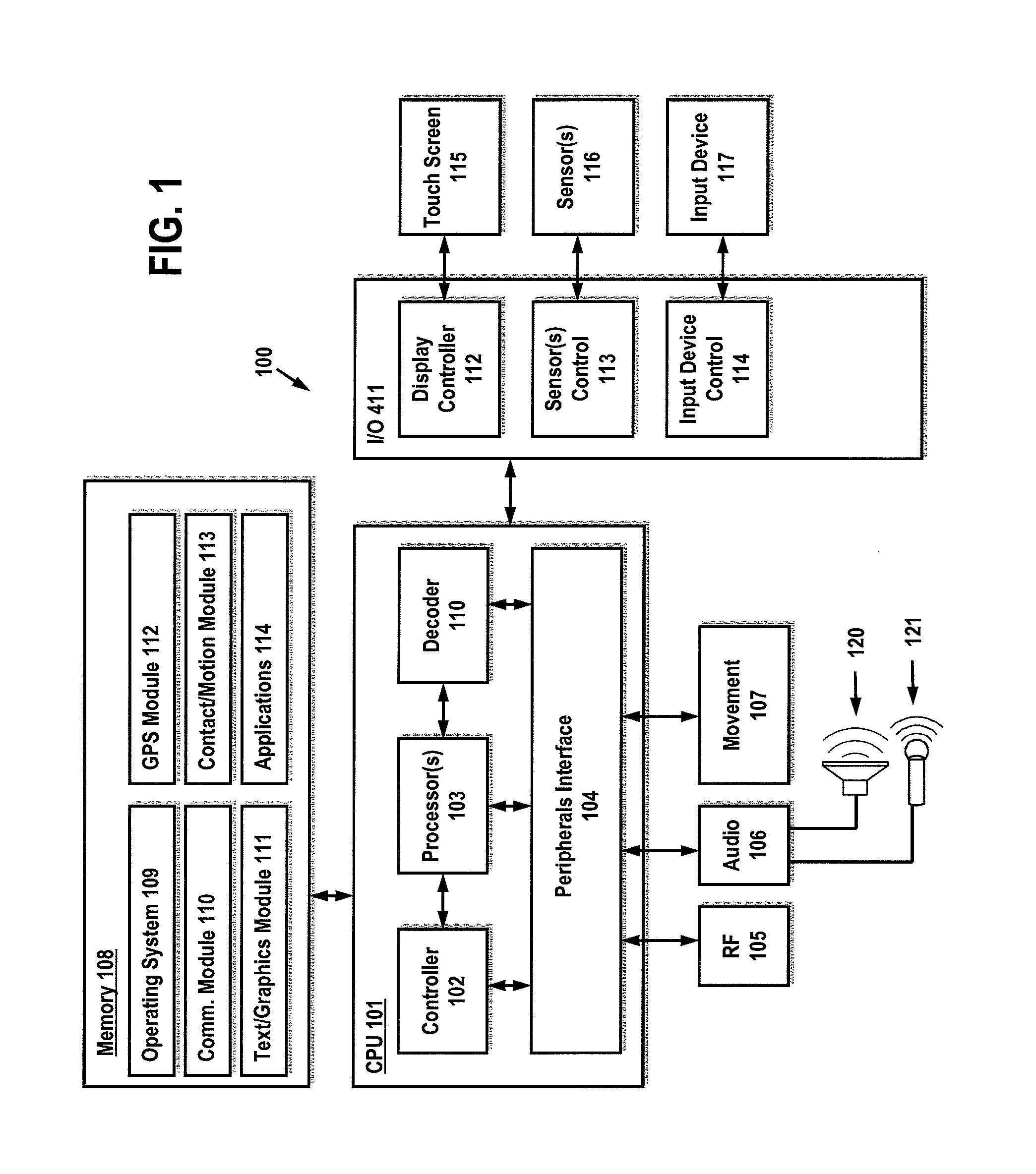

System and method to predict and avoid musculoskeletal injuries

ActiveUS20130217352A1Medical data miningHealth-index calculationTelecommunications linkMusculoskeletal injury

A miniaturized, ruggedized, field-deployable Portable Exposure Assessment System (PEAS) is used to remotely monitor workers and provide real-time warning of exposure to musculoskeletal injury conditions via alarm and smart-phone transmission. The PEAS unit wirelessly acquires exposure data from sensors; conducts initial data analysis; triggers proximal and remote alarms; sends out text messages with abnormal data, GPS locations, and time stamps to a safety office; and saves data for more extensive assessment. Sensor technology is used in this field-deployable system to simultaneously measure and collect the body loads and awkward postures imposed by package handling as well as driving-related, low-frequency vibration exposures. Wireless technology is used to set up wireless communication links between the sensors and a data logger and between the data logger and a smart phone with GPS, date / time stamp and text messaging capabilities.

Owner:THE GOVERNMENT OF THE US SEC THE DEPT OF HEALTH & HUMAN SERVICES CENT FOR DISEASE CONROL & PREVENTION

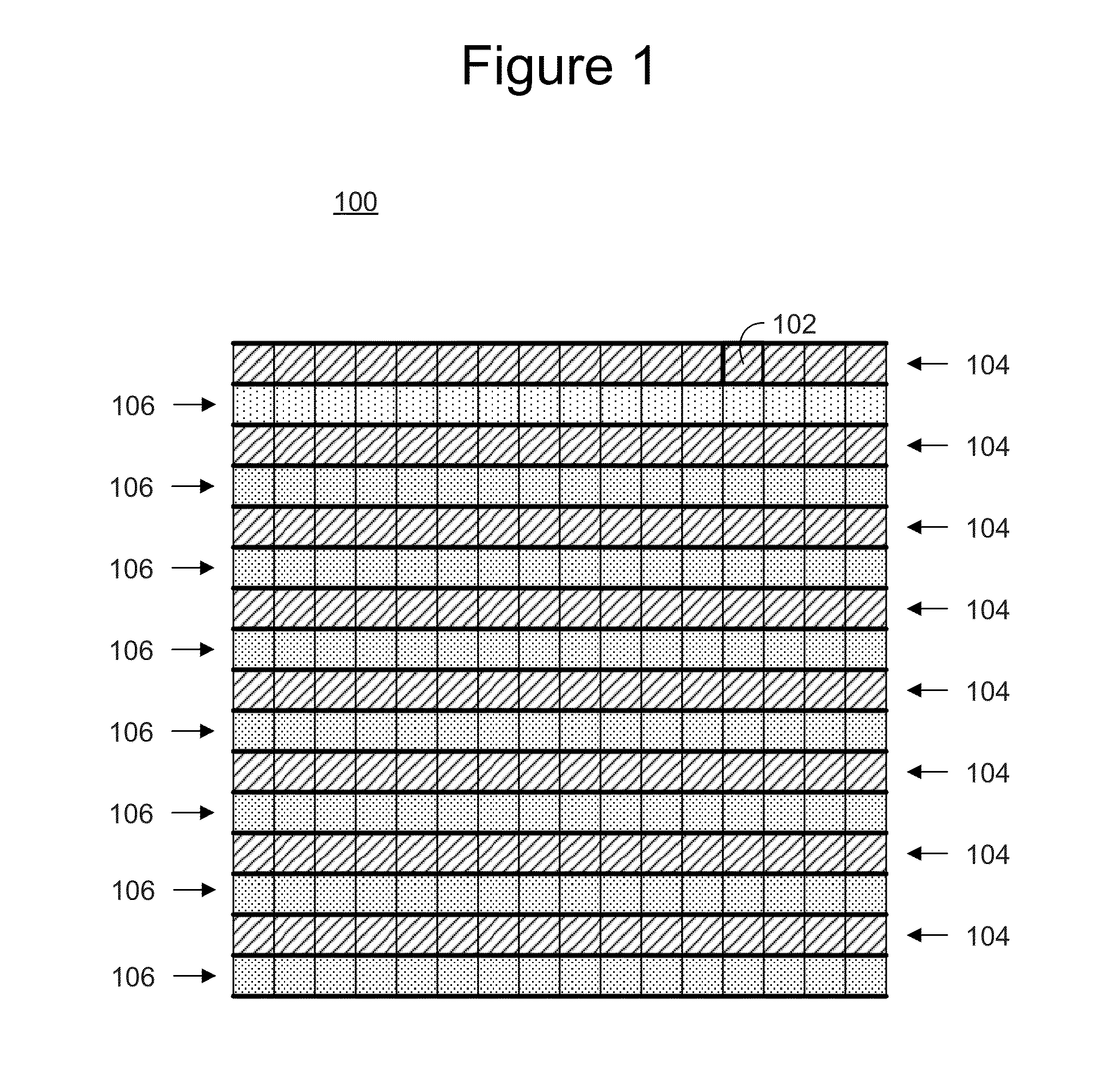

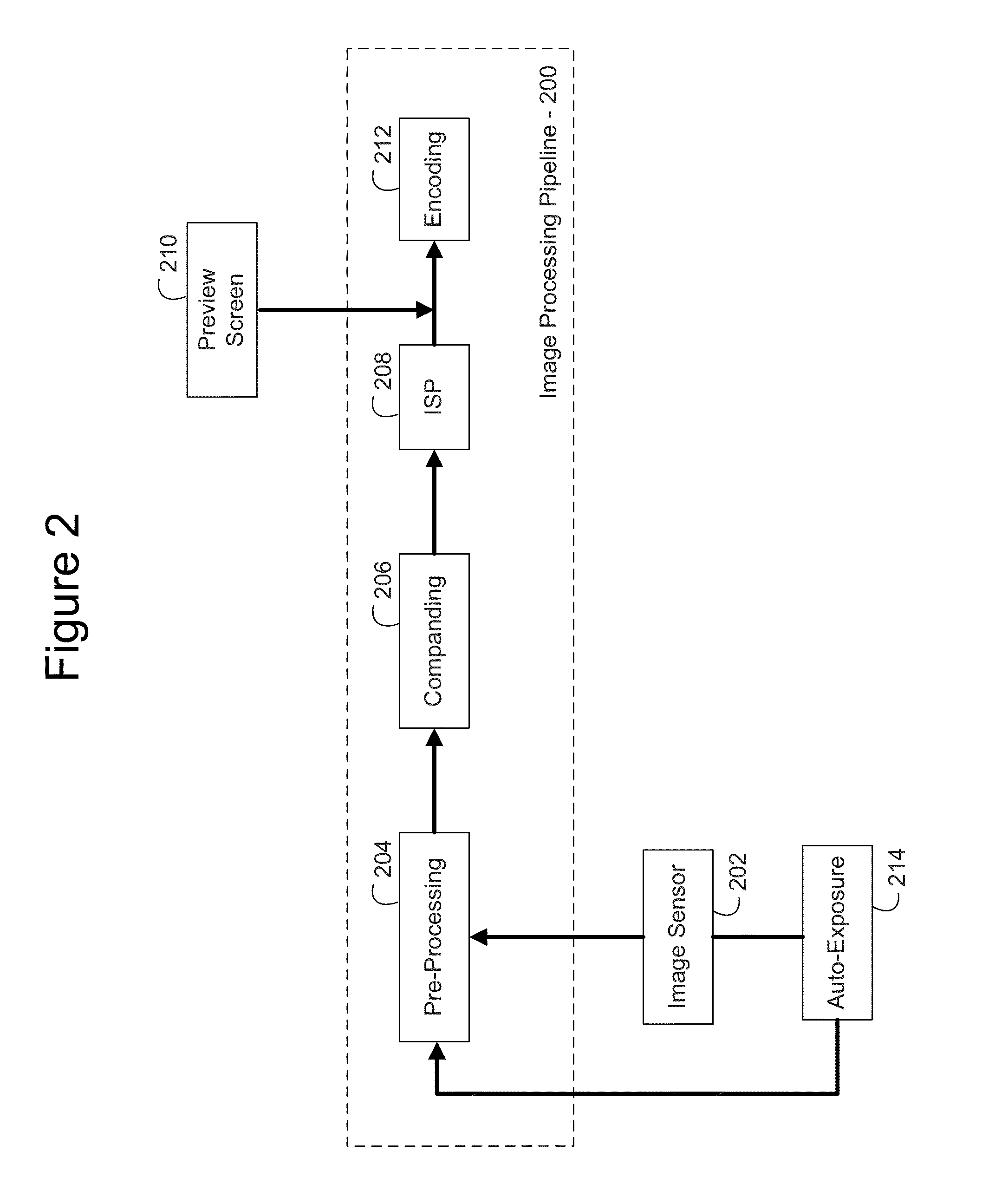

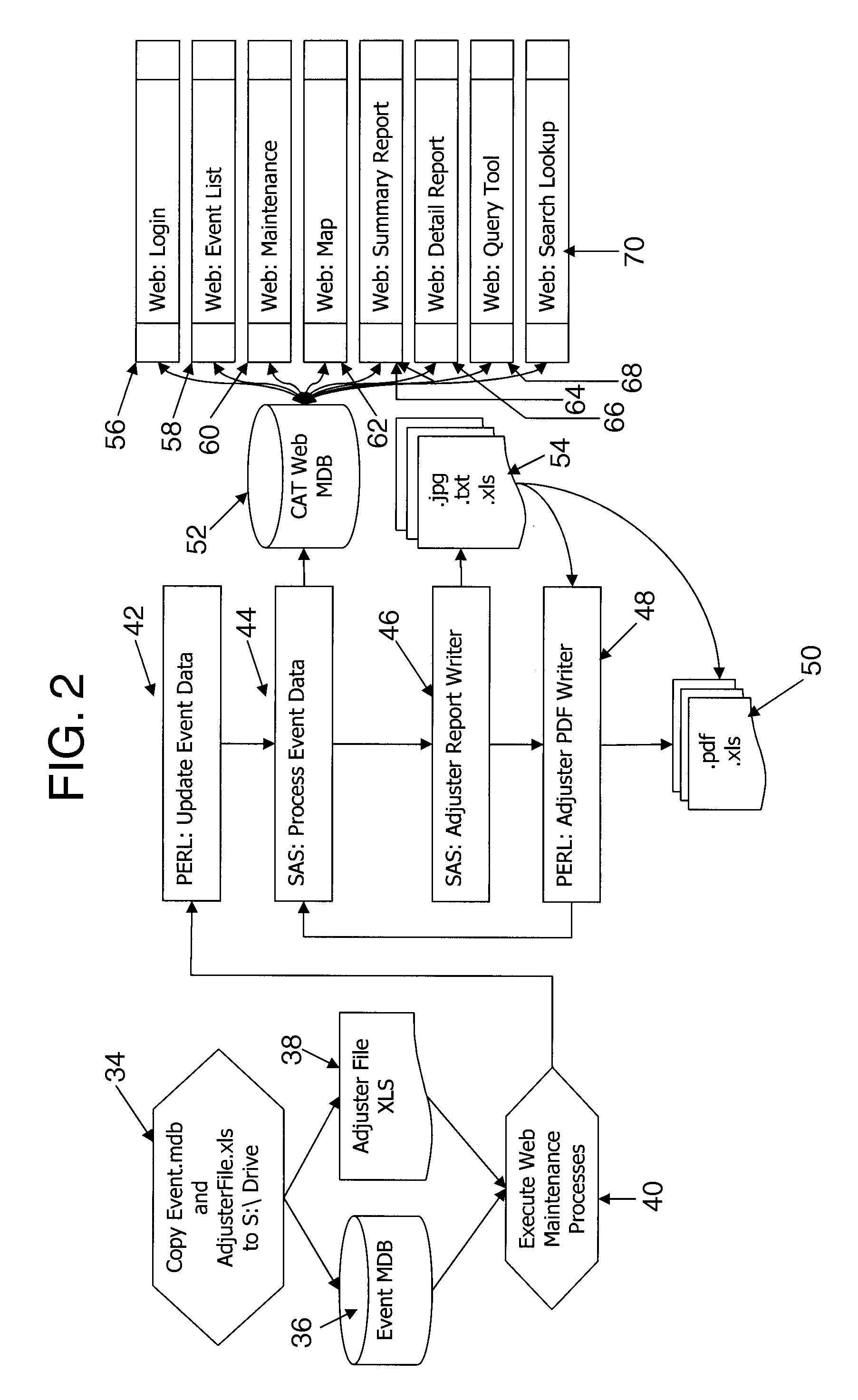

Adaptive dynamic range imaging

InactiveUS20150130967A1Improve dynamic rangeTelevision system detailsColor television detailsImaging qualitySelf adaptive

In an apparatus according to one embodiment of the present invention, a video system is disclosed. The video system comprises a pre-processing module, an auto-exposure module, and an image sensor. The image sensor is operable to simultaneously capture a first image at a long exposure and a second image at a short exposure capture. The auto-exposure module is operable to determine an average brightness of a scene for video / image capturing, wherein the determined brightness achieves a desired image quality. The auto-exposure module is further operable to select a dynamic range necessary to preserve desired details in a captured scene. The auto-exposure module is further operable to instruct the image sensor to capture the first image and the second image with a selected exposure ratio to achieve the desired dynamic range. The pre-processing module is operable to combine the first image and the second image into a final image with the desired dynamic range.

Owner:NVIDIA CORP

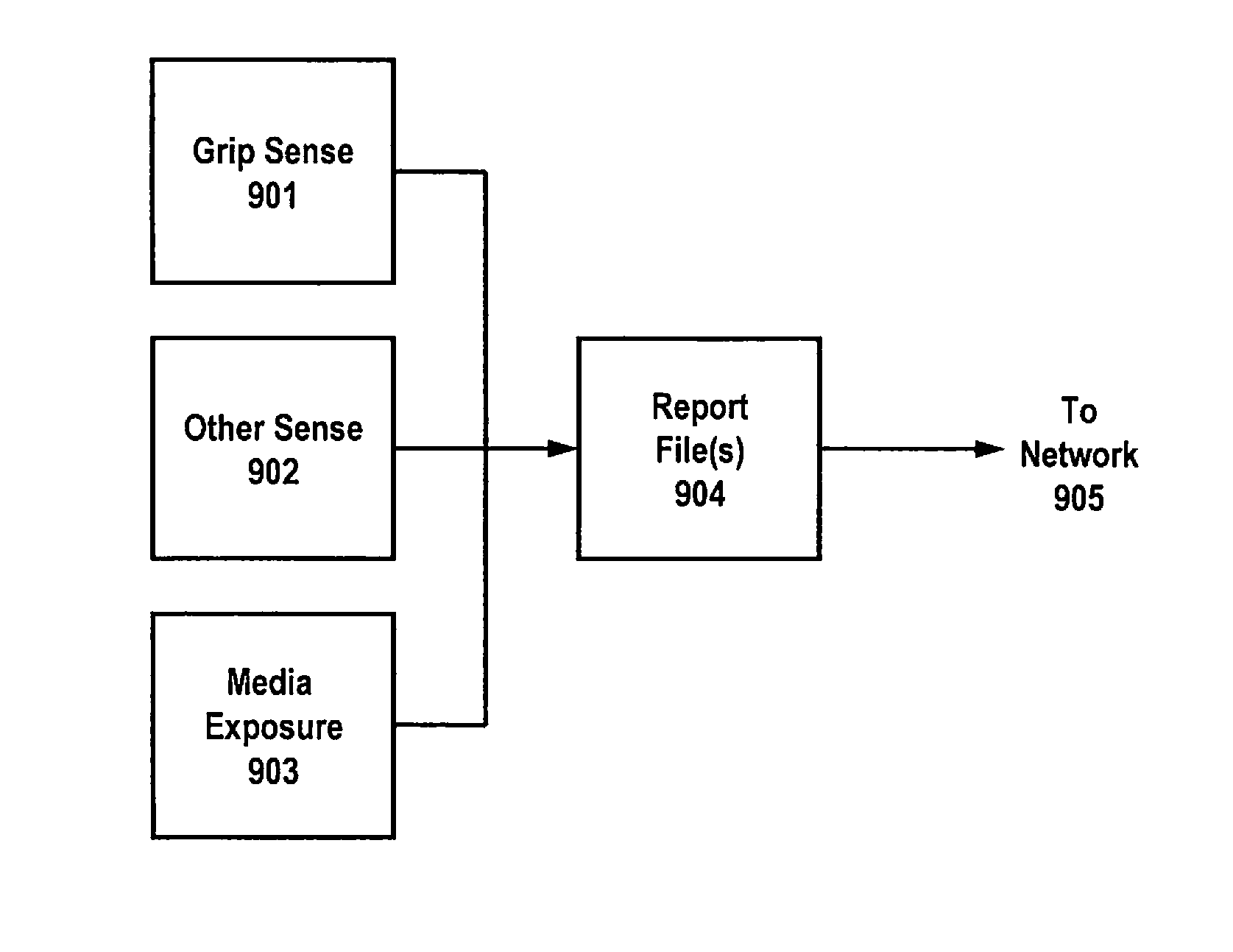

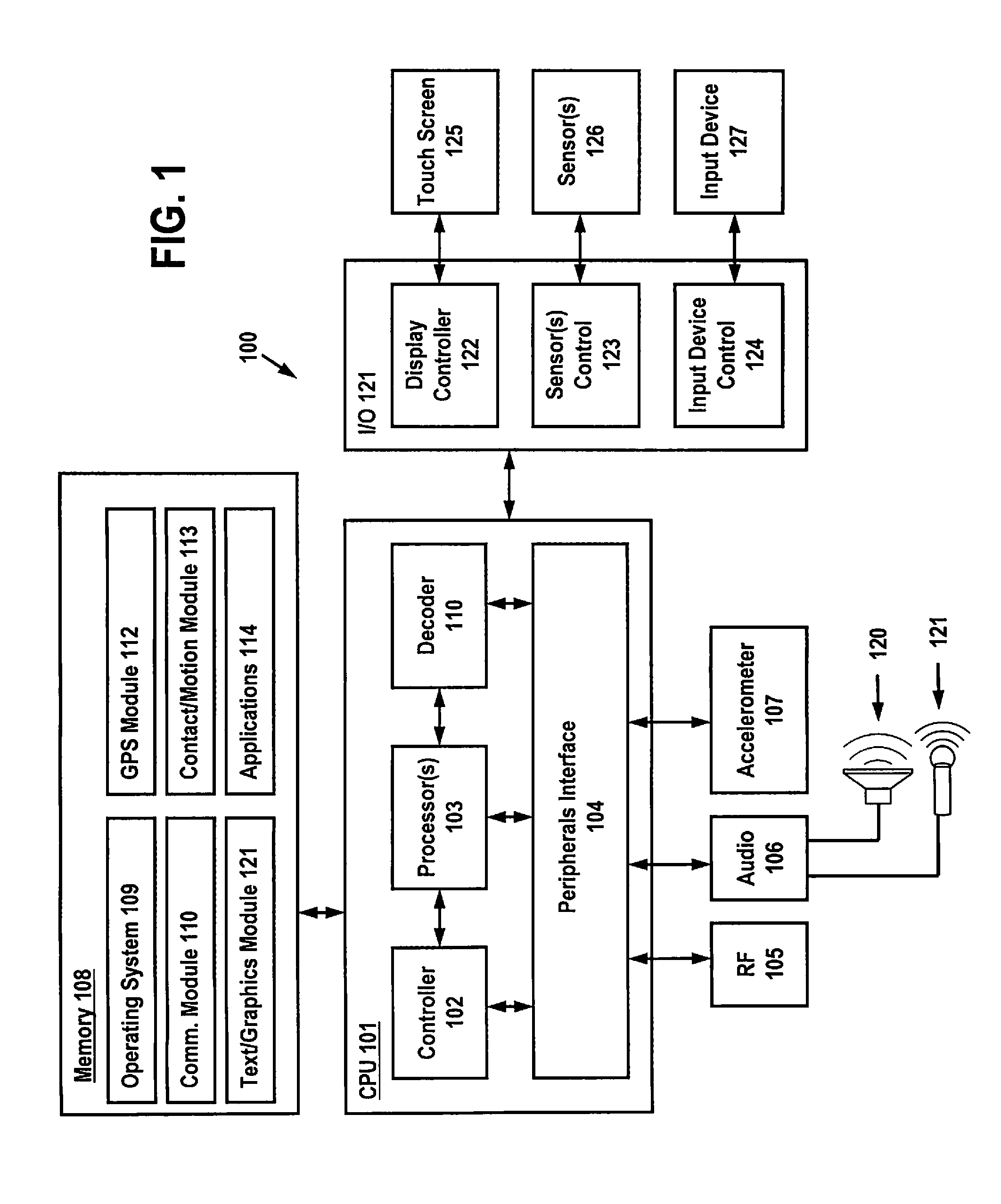

Audience Measurement System, Method and Apparatus with Grip Sensing

A system, apparatus and method for determining grip sensing for a portable device that is configured to produce media exposure data. At least one sensor associated with a portable device produces sensed grip readings representing a manner in which the device was grasped. The sensed grip readings may be processed to determine a manner of usage or a user identity. Additional sensor readings, such as touch screen readings and accelerometer readings may be combined with the grip sensing. The sensor data may be combined with the media exposure data for report generation for audience measurement purposes.

Owner:THE NIELSEN CO (US) LLC

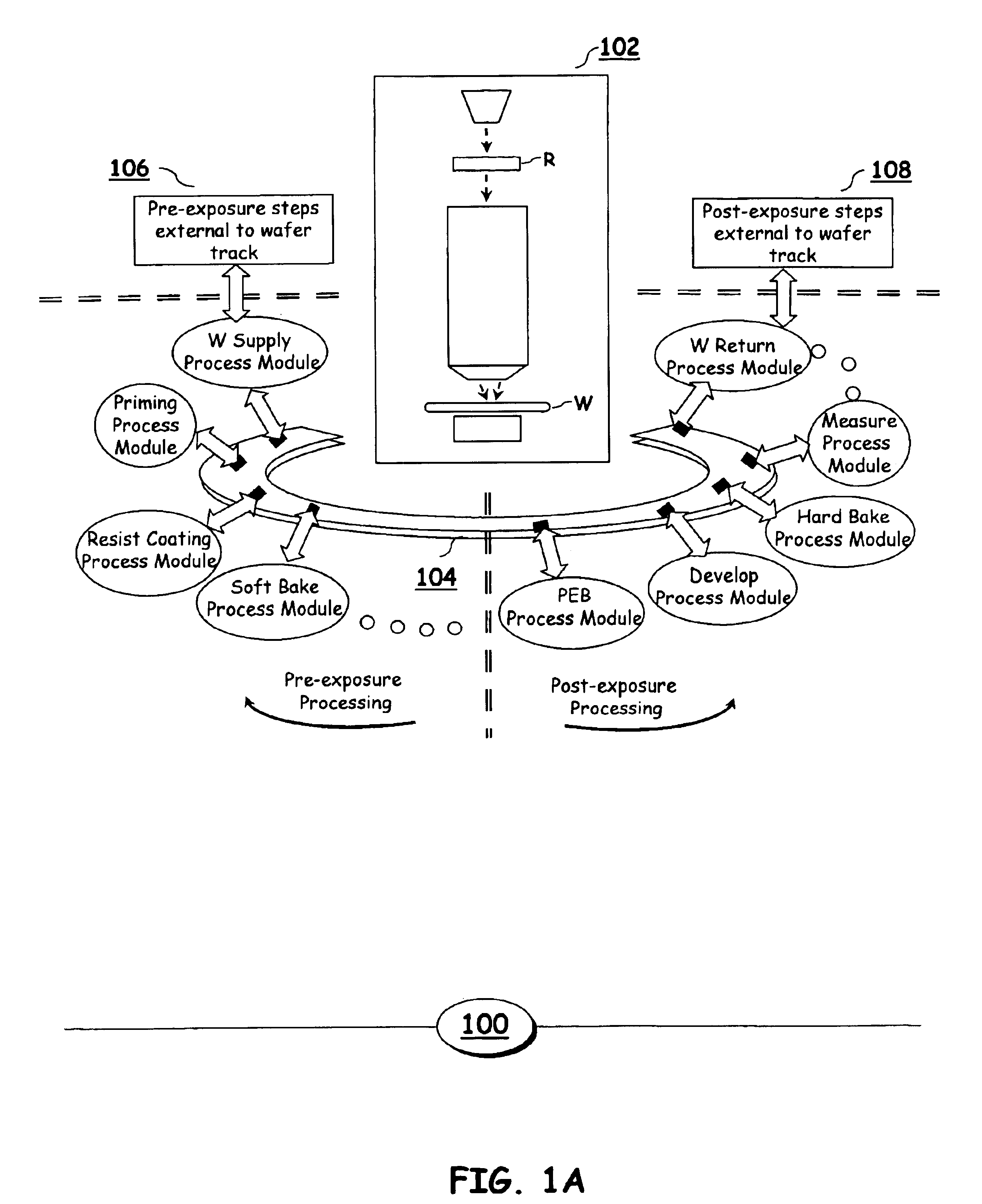

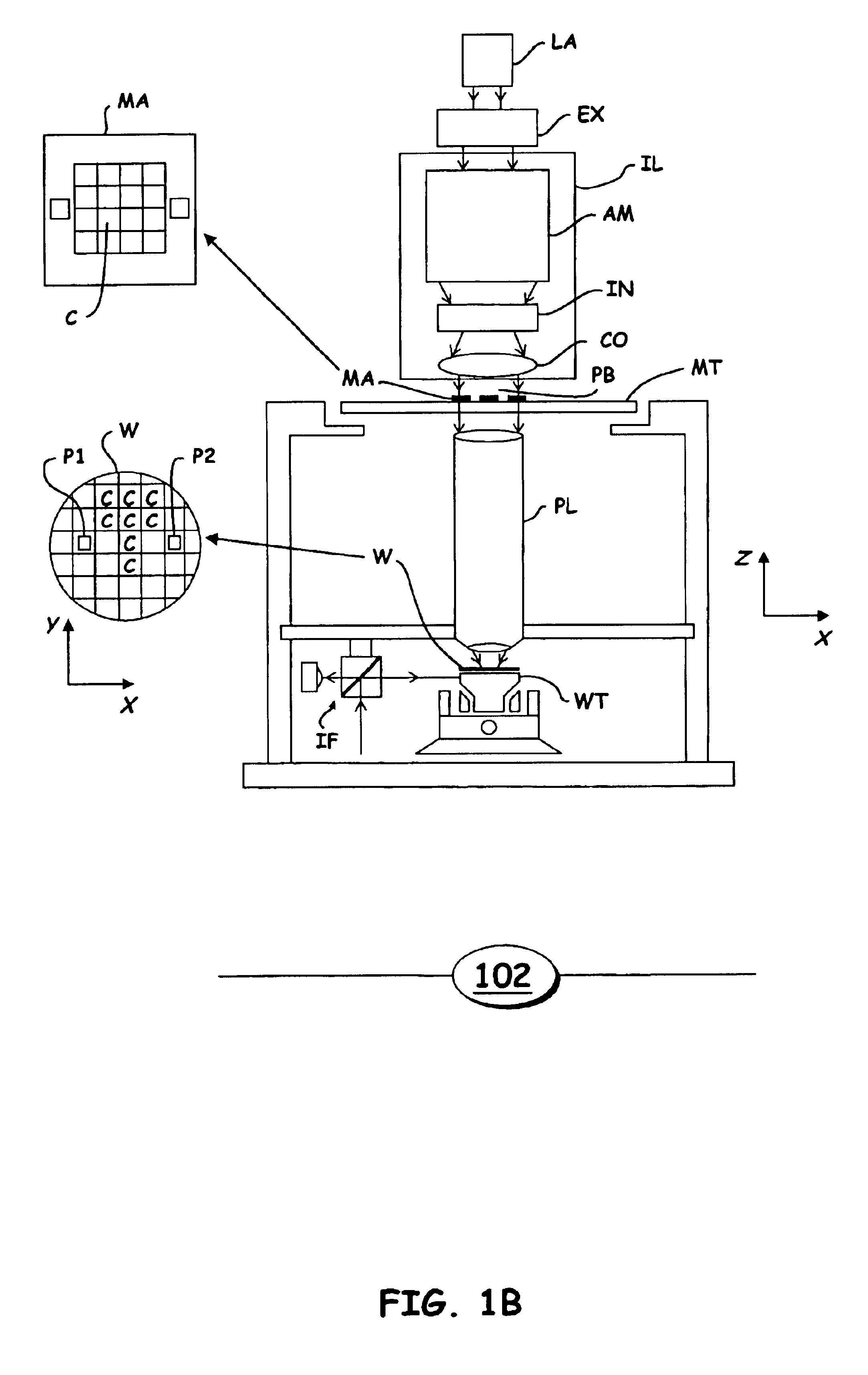

Adaptive lithographic critical dimension enhancement

InactiveUS20050075819A1Resistance/reactance/impedenceError detection/correctionEngineeringCritical dimension

A system, apparatus, and method for improving CD uniformity in lithographic system is presented herein. The system includes an exposure apparatus configured to expose substrates, a track apparatus that is operatively coupled to the exposure apparatus and a plurality of processing modules and apparatus. The system also includes a measuring device configured to measure attributes of the exposed and processed substrates and to assess whether the exposed and processed substrate attributes are uniform based on pre-specified substrate profile information. The system further includes a module configured to adaptively calculate corrective exposure data based on the measured attributes upon determining that said attributes are not uniform. The corrective exposure data is configured to correct for non-uniformities in the substrates by regulating the exposure dosage of the exposure apparatus. Once the substrates are assessed to achieve the desired uniformity, the substrates are exposed by the exposure apparatus in accordance with the corrective exposure data, the uniformity of the exposed substrate continues to be monitored and the dose corrections are updated as required to maintain uniformity.

Owner:ASML NETHERLANDS BV

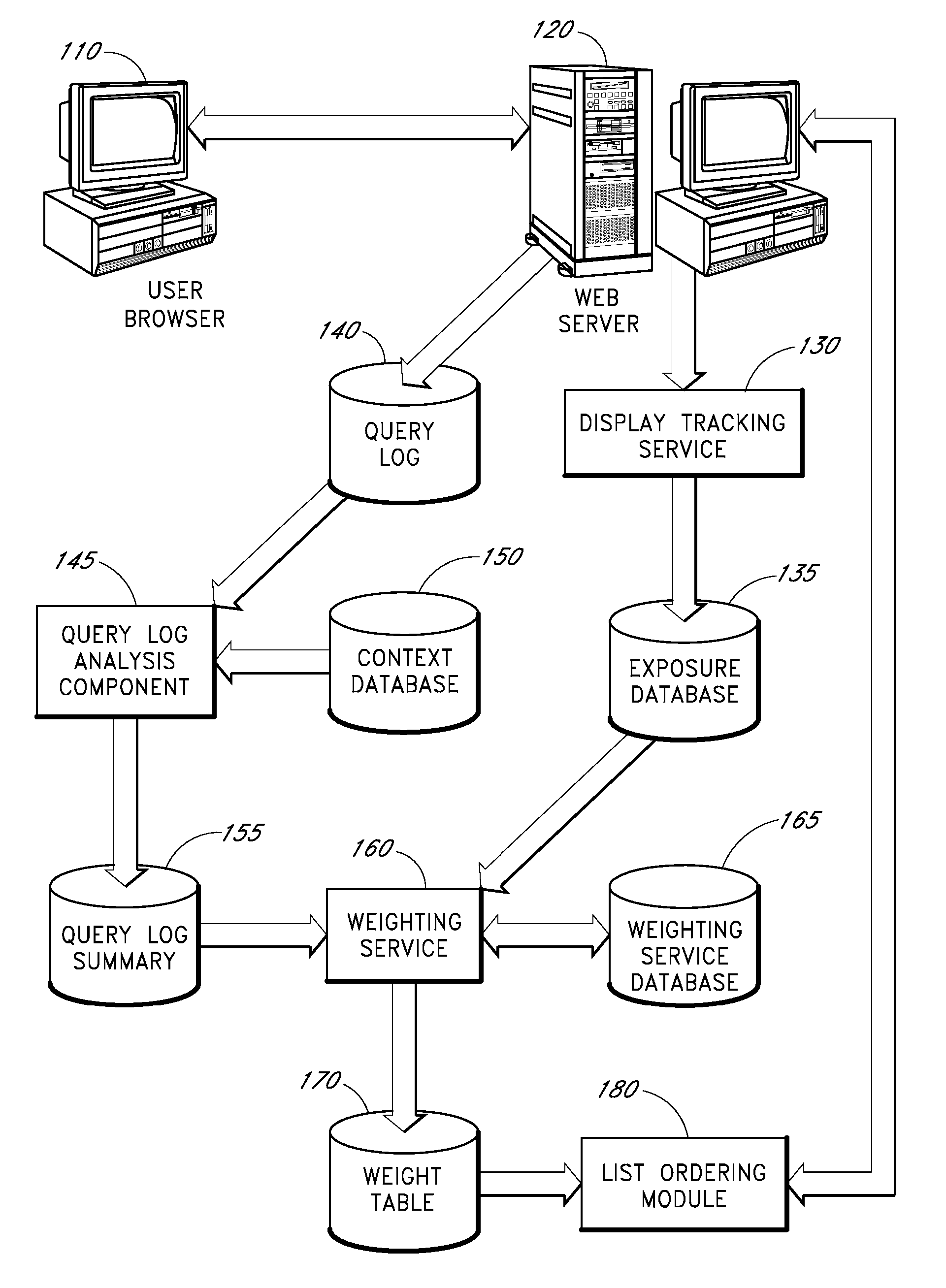

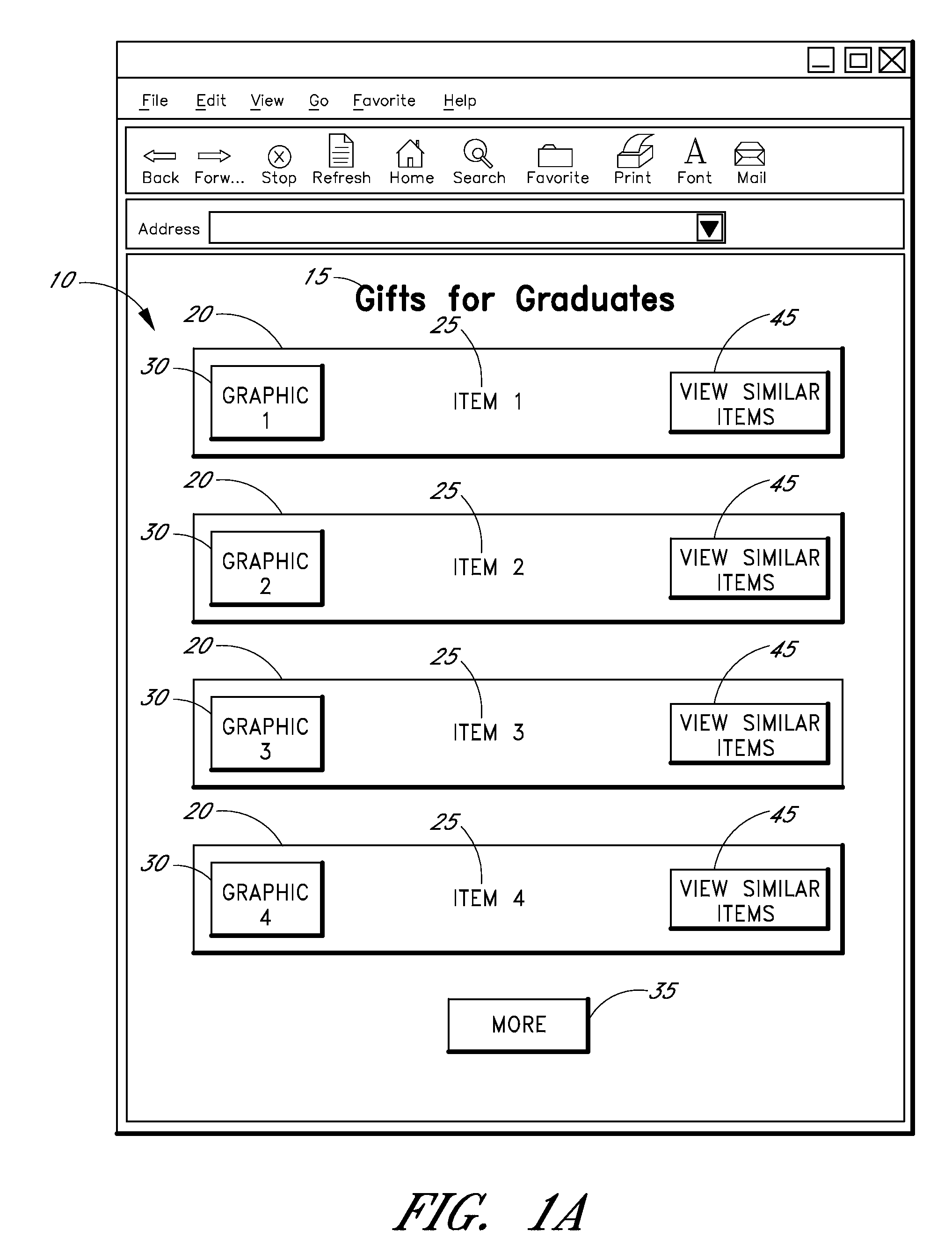

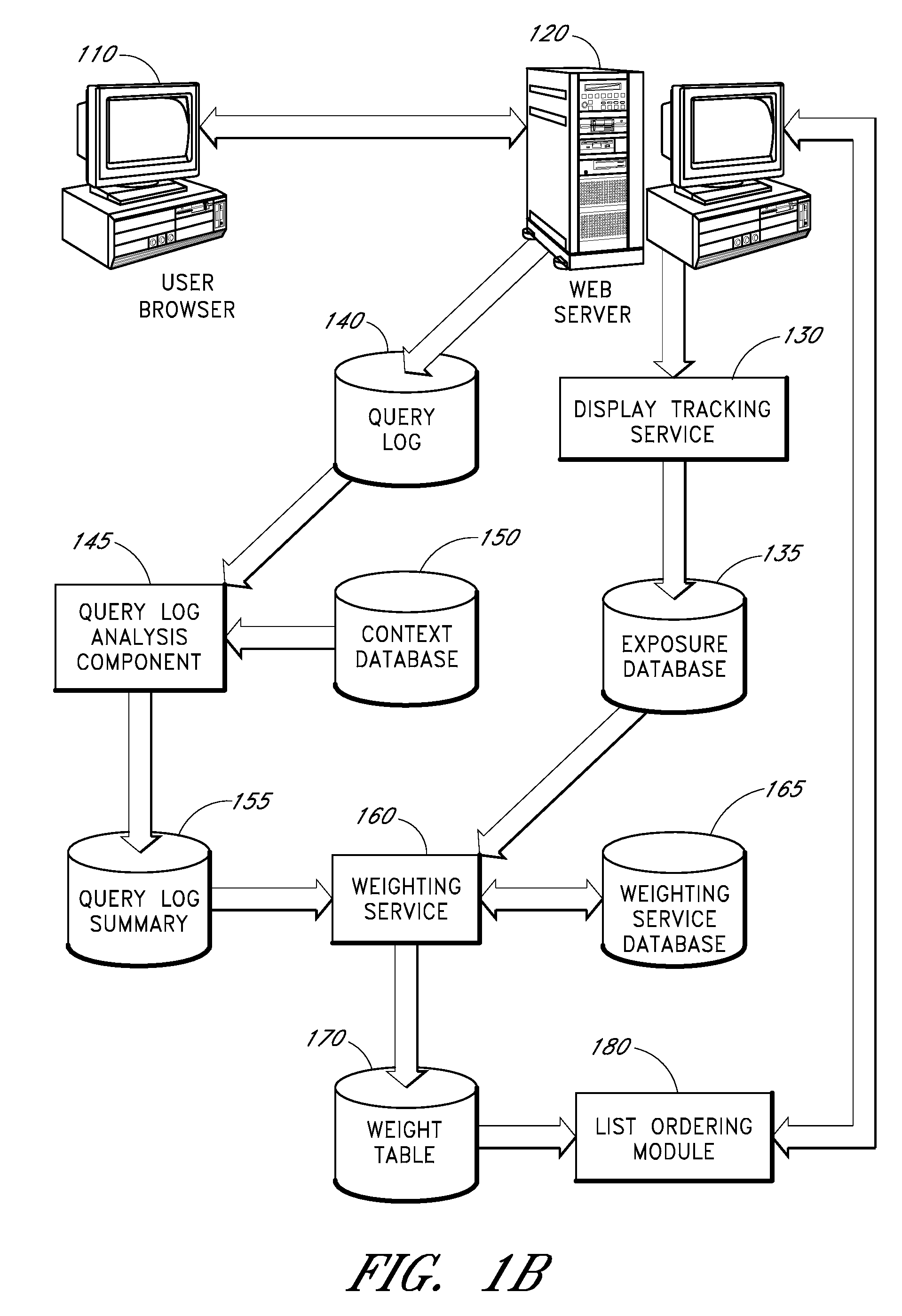

Computer processes for adaptively selecting and/or ranking items for display in particular contexts

A computer-implemented system and method are disclosed that are capable of refining the order and / or content of a list of items. In one embodiment, user activity associated with each item displayed to users in a given context is monitored, and is used together with item exposure data to generate context-specific item weights. The weights for the same item in different contexts may be different. The selection of items included in a list presented to users, and / or the order in which the items in the list are displayed, may be adjusted over time based upon the relative weights associated with the items.

Owner:A9 COM INC

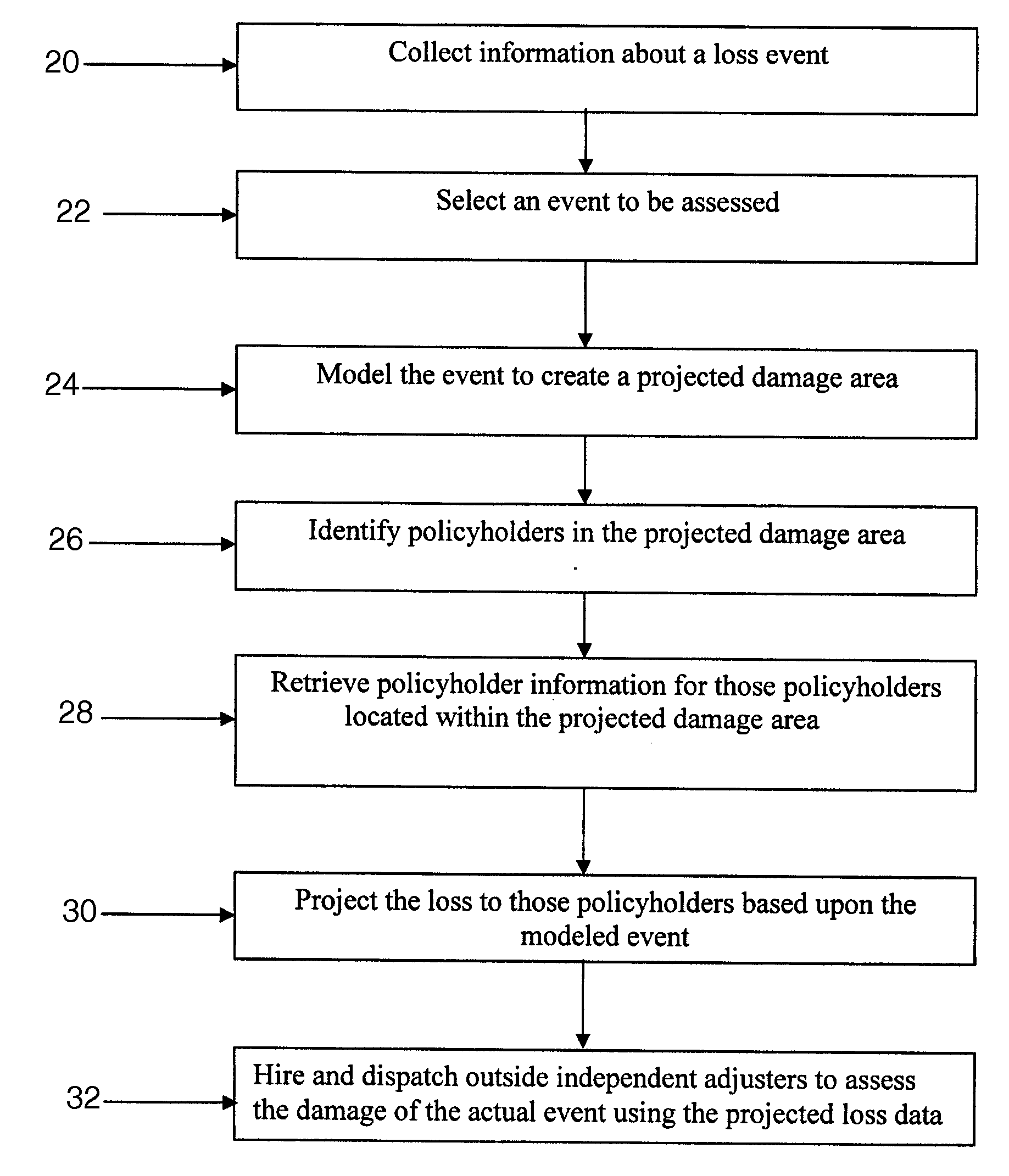

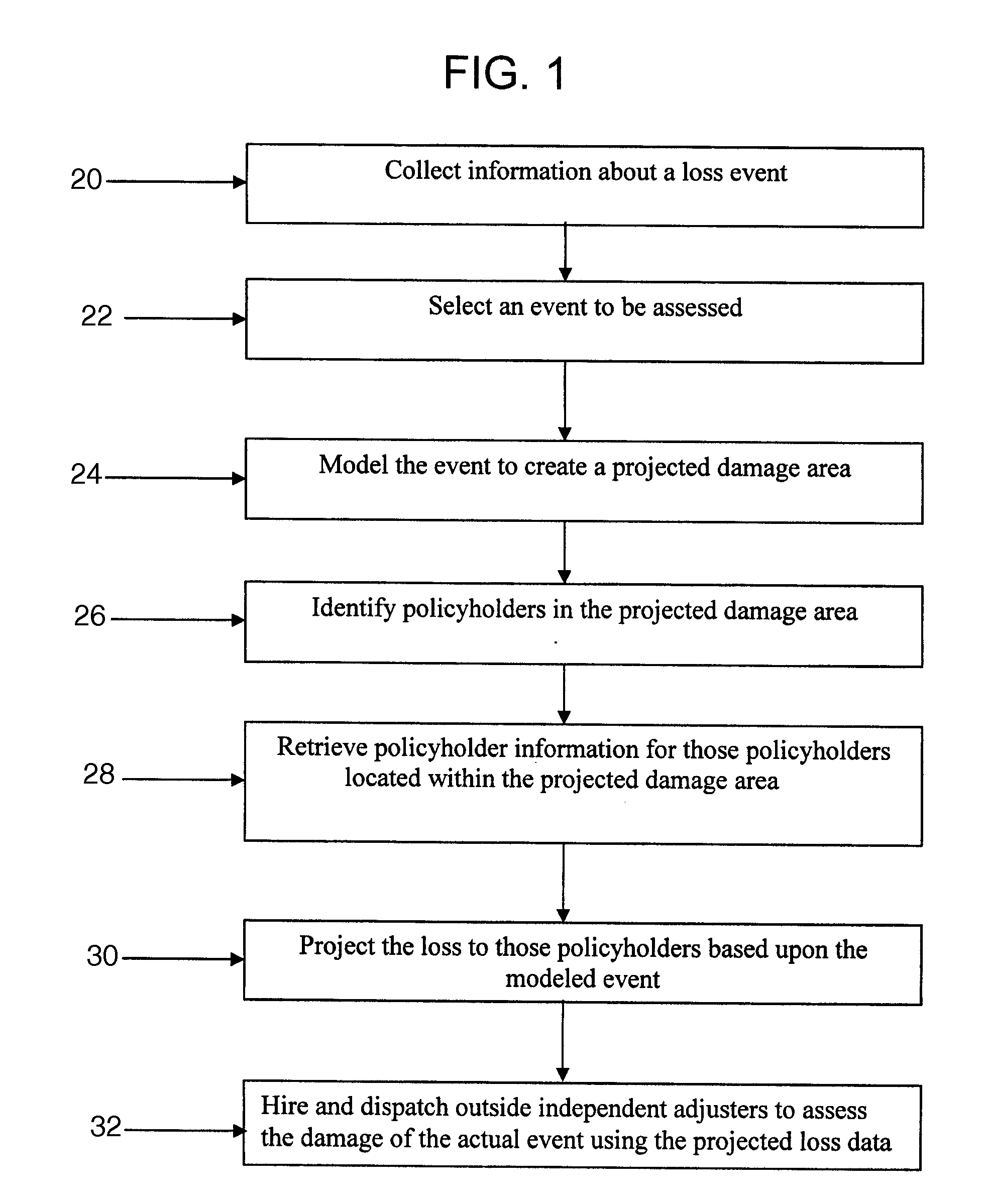

Method and system for projecting catastrophe exposure

A web-based application for an insurance carrier that combines national account information and detailed insurance policy information with catastrophe modeling technology. As an event occurs, the modeling technology determines a projected damage area that the event will cause. The insurance carrier can cross-reference that information with its account and policy information. In a short time, the insurance carrier can generate the following catastrophe exposure data: (1) summary reports indicating the projected number of damaged locations for each account; (2) maps and graphs of each account's affected locations that provide a visual image of the epicenter and the concentration of the losses; and (3) tables with detailed property location information. After receiving this data, the insurance carrier can secure the services of independent adjusters and assign other resources according to the scope and magnitude of the projected loss.

Owner:AMERICAL INTERNATIONAL GROUP INC

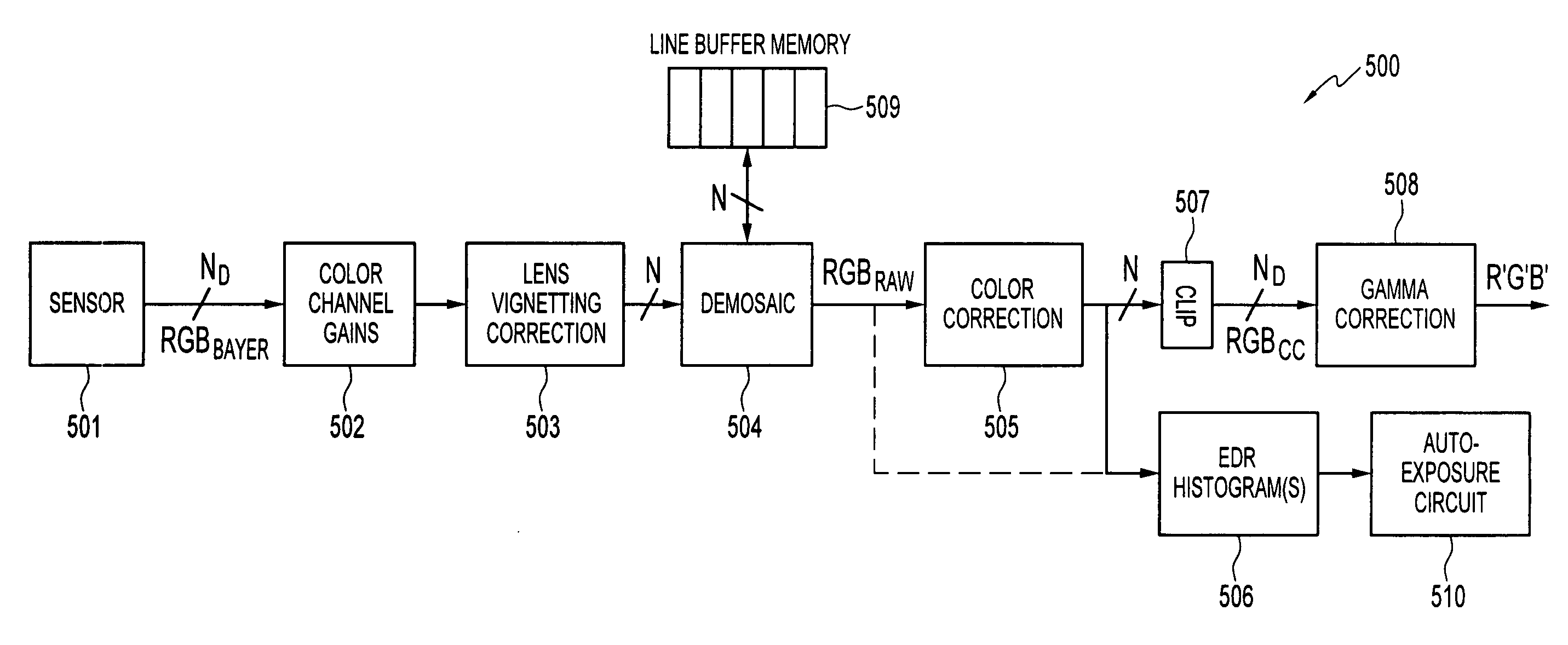

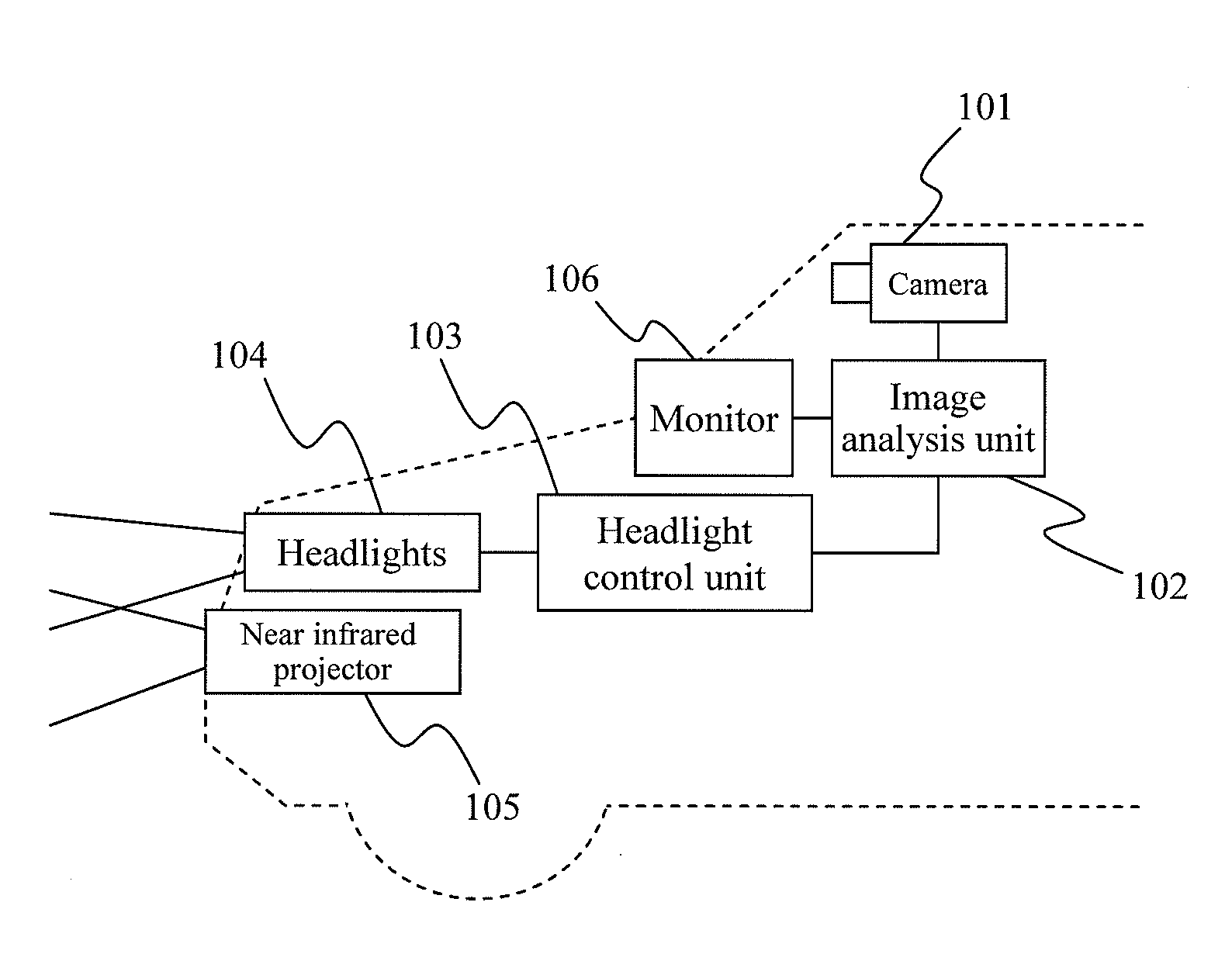

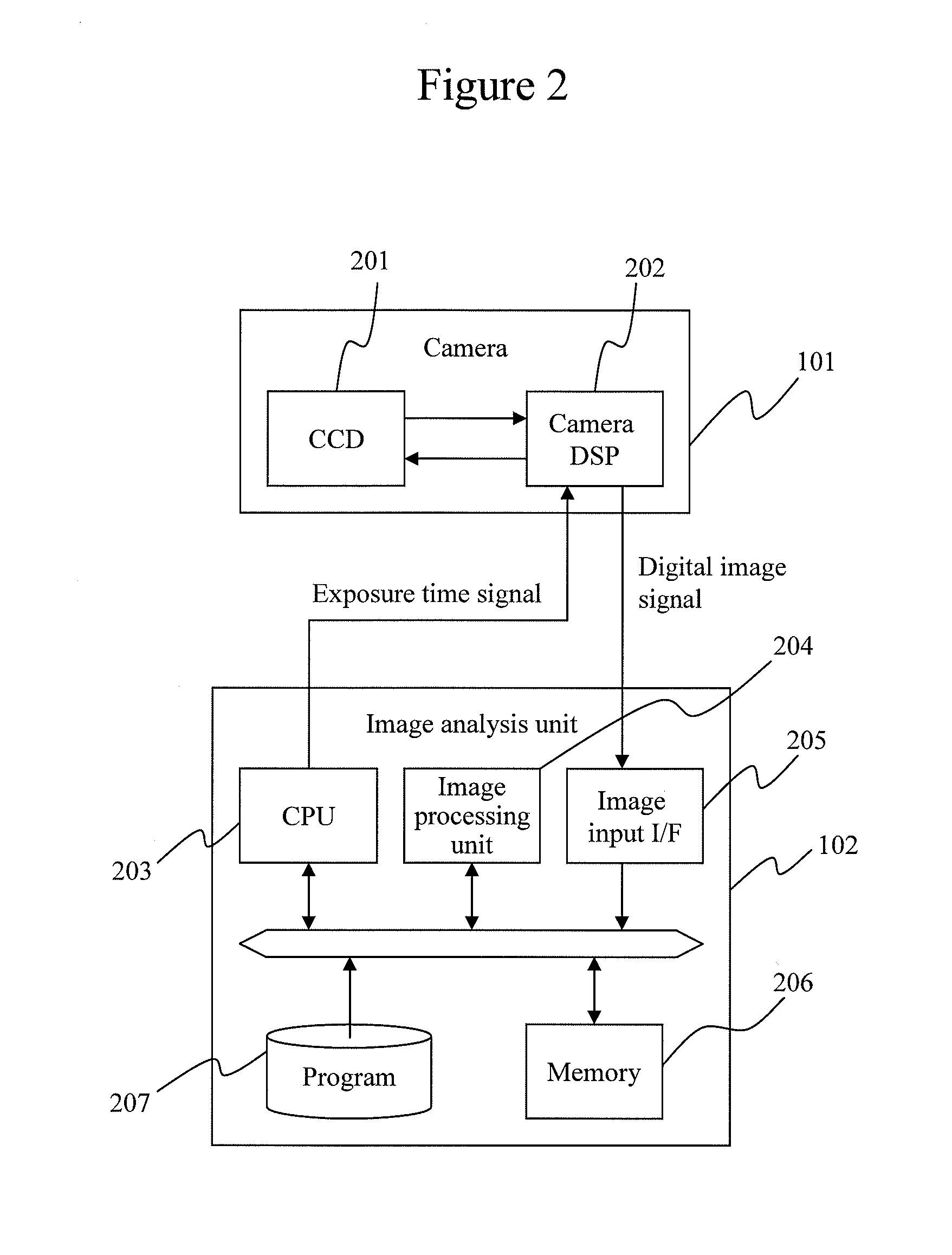

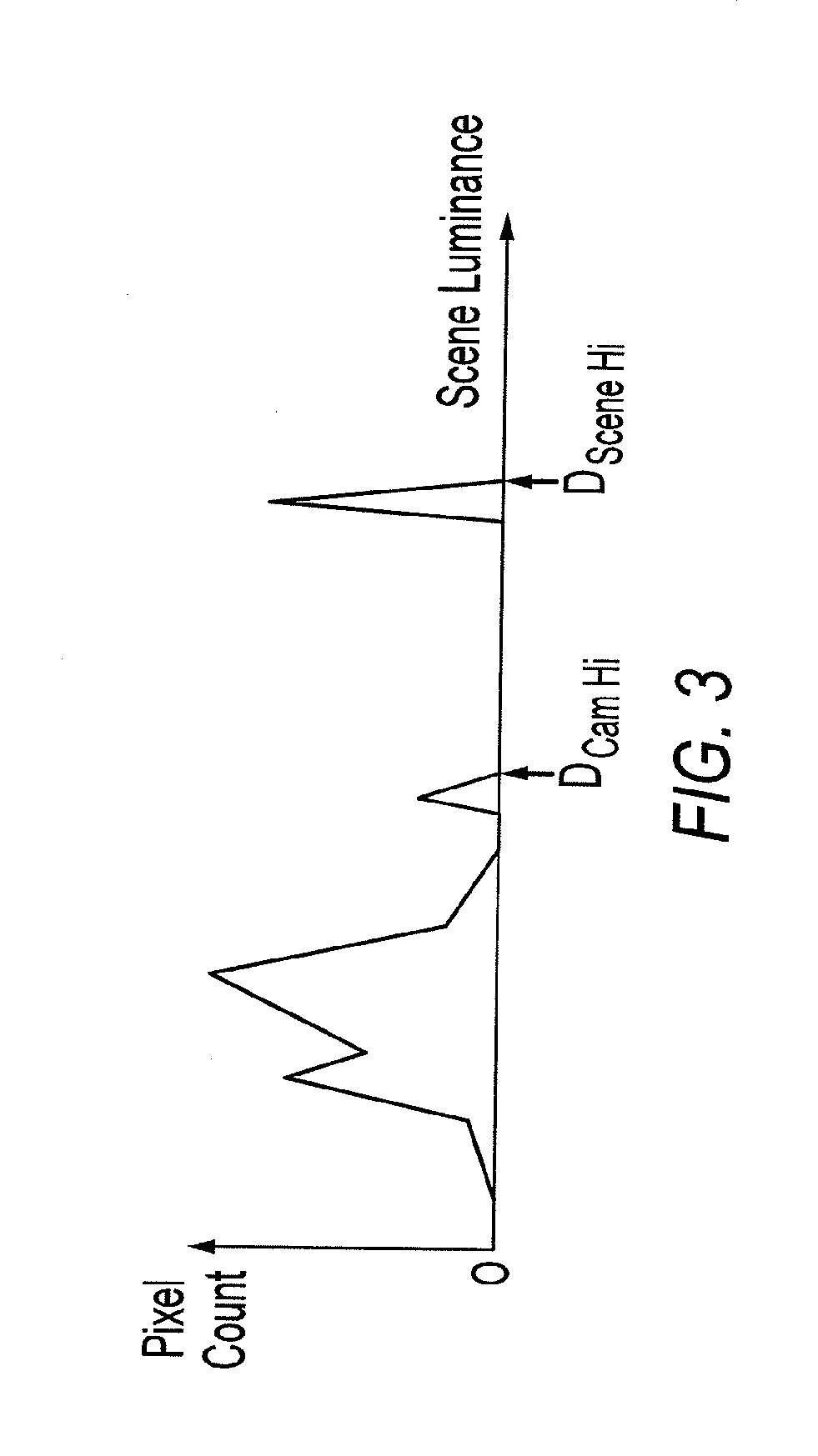

Method, apparatus and system for dynamic range estimation of imaged scenes

ActiveUS20080056704A1Television system detailsColor television detailsCamera lensExposure Elapsed Time

A method, apparatus, and system for dynamic range estimation of imaged scenes for automatic exposure control. For a given exposure time setting, certain areas of a scene may be brighter than what a camera can capture. In cameras, including those experiencing substantial lens vignetting, a gain stage may be used to extend dynamic range and extract auto-exposure data from the extended dynamic range. Alternatively, dynamic range can be extended using pre-capture image information taken under reduced exposure conditions.

Owner:MICRON TECH INC

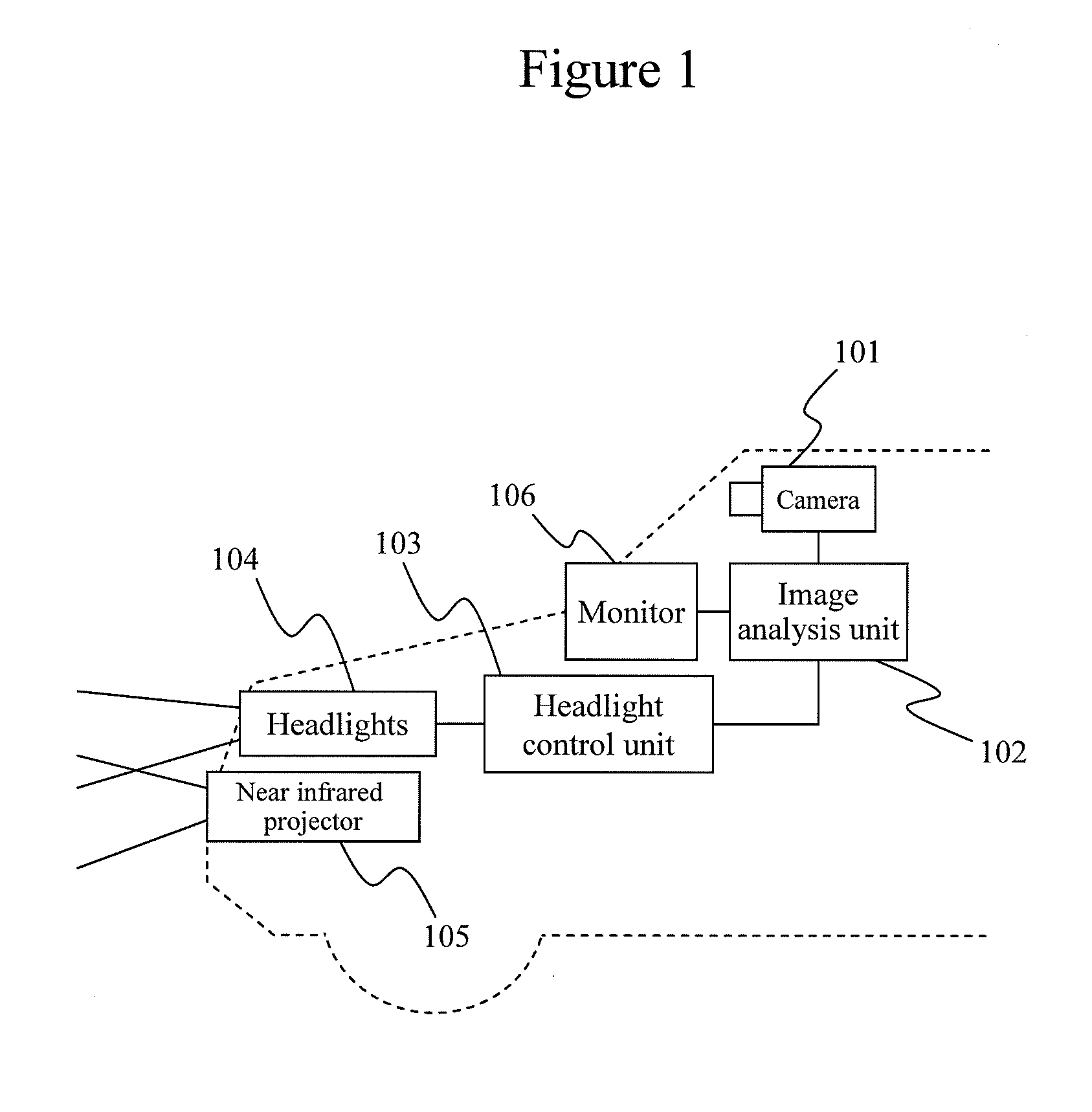

Image Processing Apparatus

InactiveUS20120062746A1Improve accuracyLow costTelevision system detailsAnti-collision systemsColor imageImaging processing

An image processing apparatus capable of detecting, simultaneously and with high precision, headlights of oncoming cars, taillights of cars ahead, and pedestrians at night, the image processing apparatus comprising: means that obtains first exposure data at a first shutter speed; means that obtains second exposure data at a second shutter speed that is slower than the shutter speed; means that obtains third exposure data at a third shutter speed that is slower than the first shutter speed; means that converts the first exposure data into a visible grayscale image; means that outputs the visible grayscale image; means that converts the second exposure data into a color image; means that outputs the color image; means that converts the third exposure data into an infrared grayscale image; means that outputs the infrared grayscale image; means that detects a headlight based on the visible grayscale image; means that detects a taillight based on the color image; and means that detects a pedestrian based on an image obtained by processing the infrared grayscale image and the color image.

Owner:HITACHI AUTOMOTIVE SYST LTD

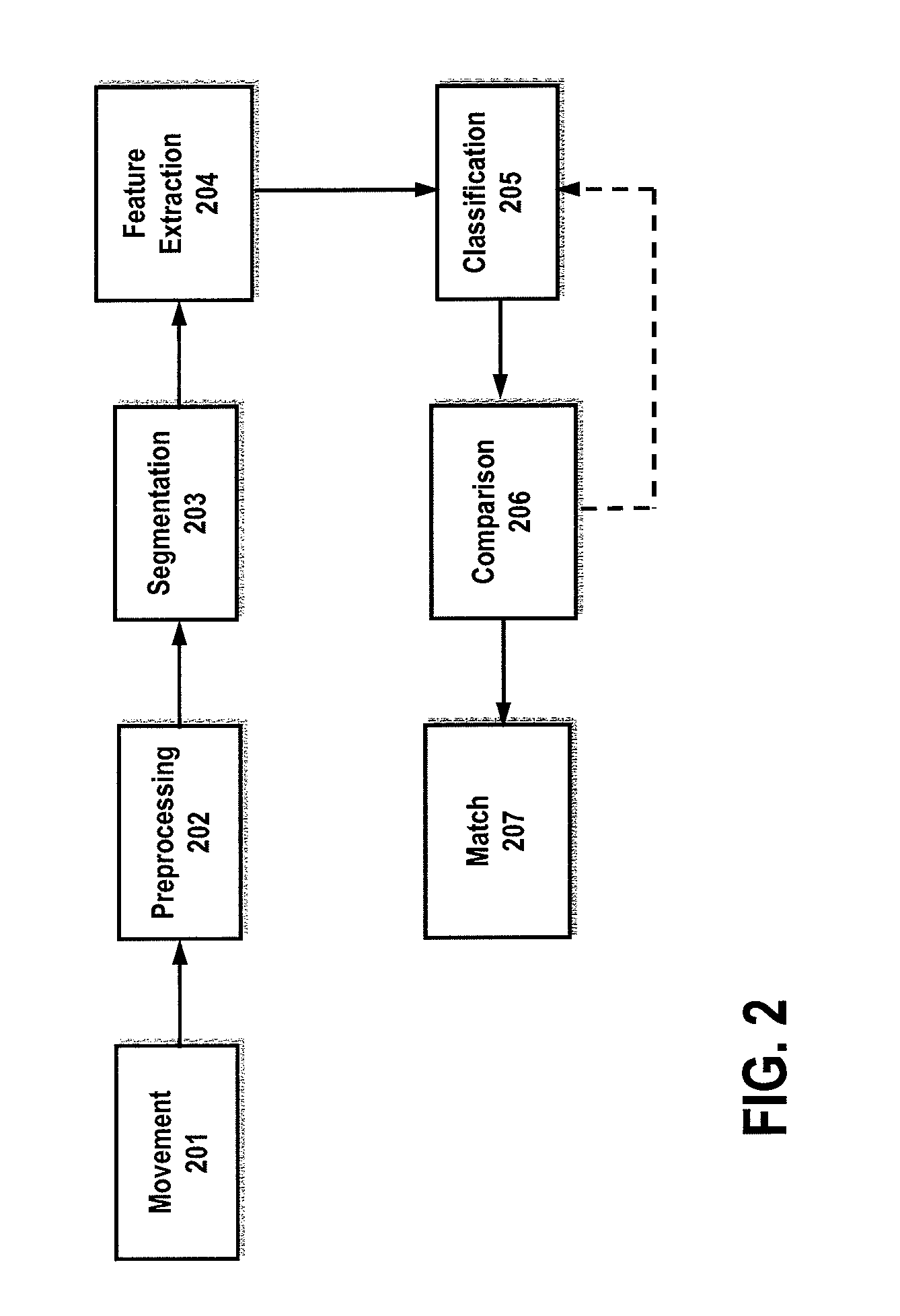

Multiple meter detection and processing using motion data

ActiveUS20130138388A1Digital computer detailsSpecial data processing applicationsUser deviceAccelerometer

Systems and methods are disclosed for identifying users of portable user devices according to one or more accelerometer profiles created for a respective user. During a media session, the portable computing device collects media exposure data, while at the same time, collects data from the accelerometer and compares it to the user profile. The comparison authenticates the user and determines the physical activity the user is engaged in. Additional data may be collected from the portable computing device to determine one or more operational conditions of the device itself, including the detection of multiple devices being physically carried by one user. Gross motion strings may also be generated by devices and compared to see if strings match, thus suggesting multiple devices are being carried by one user.

Owner:THE NIELSEN CO (US) LLC

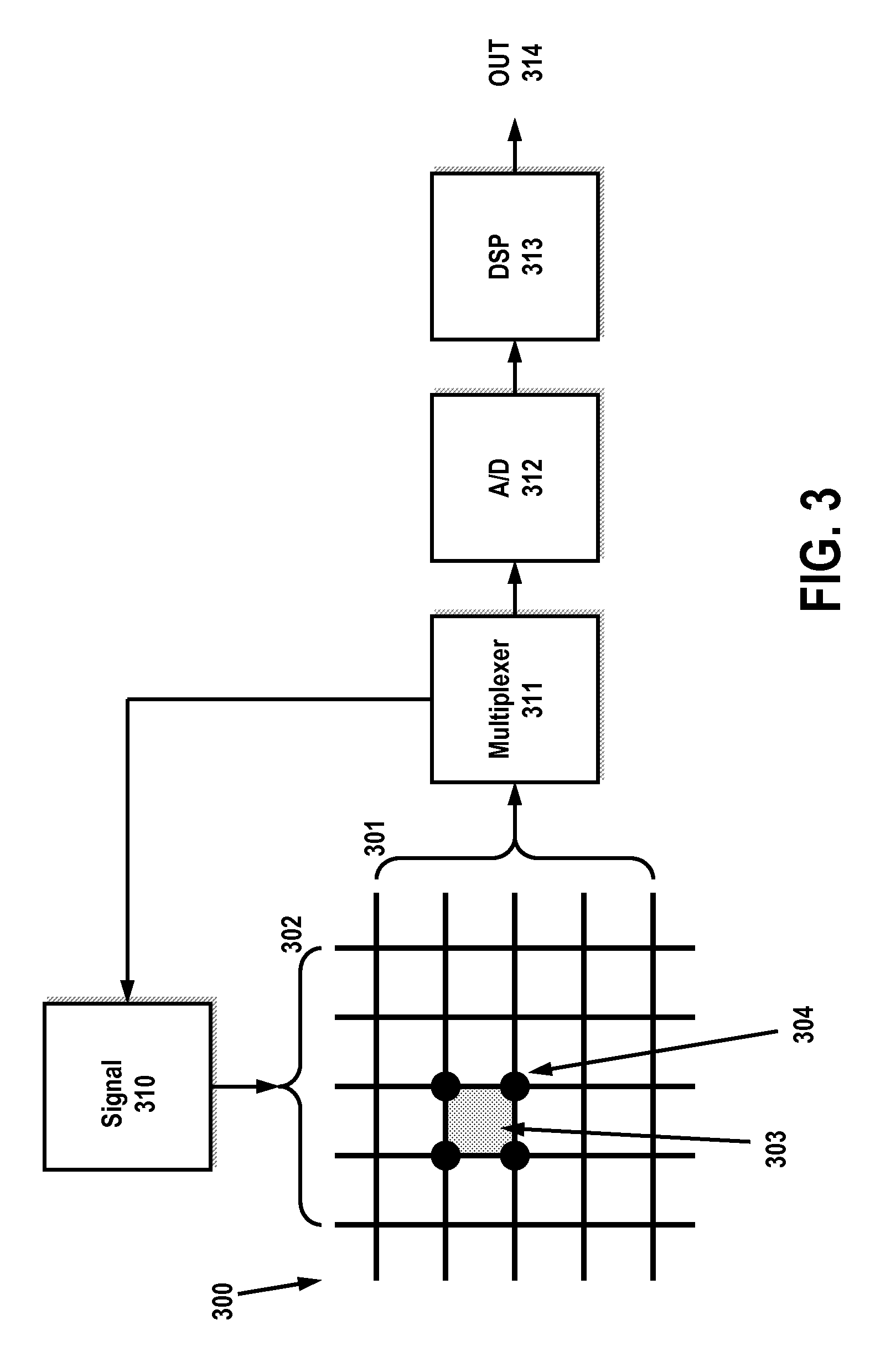

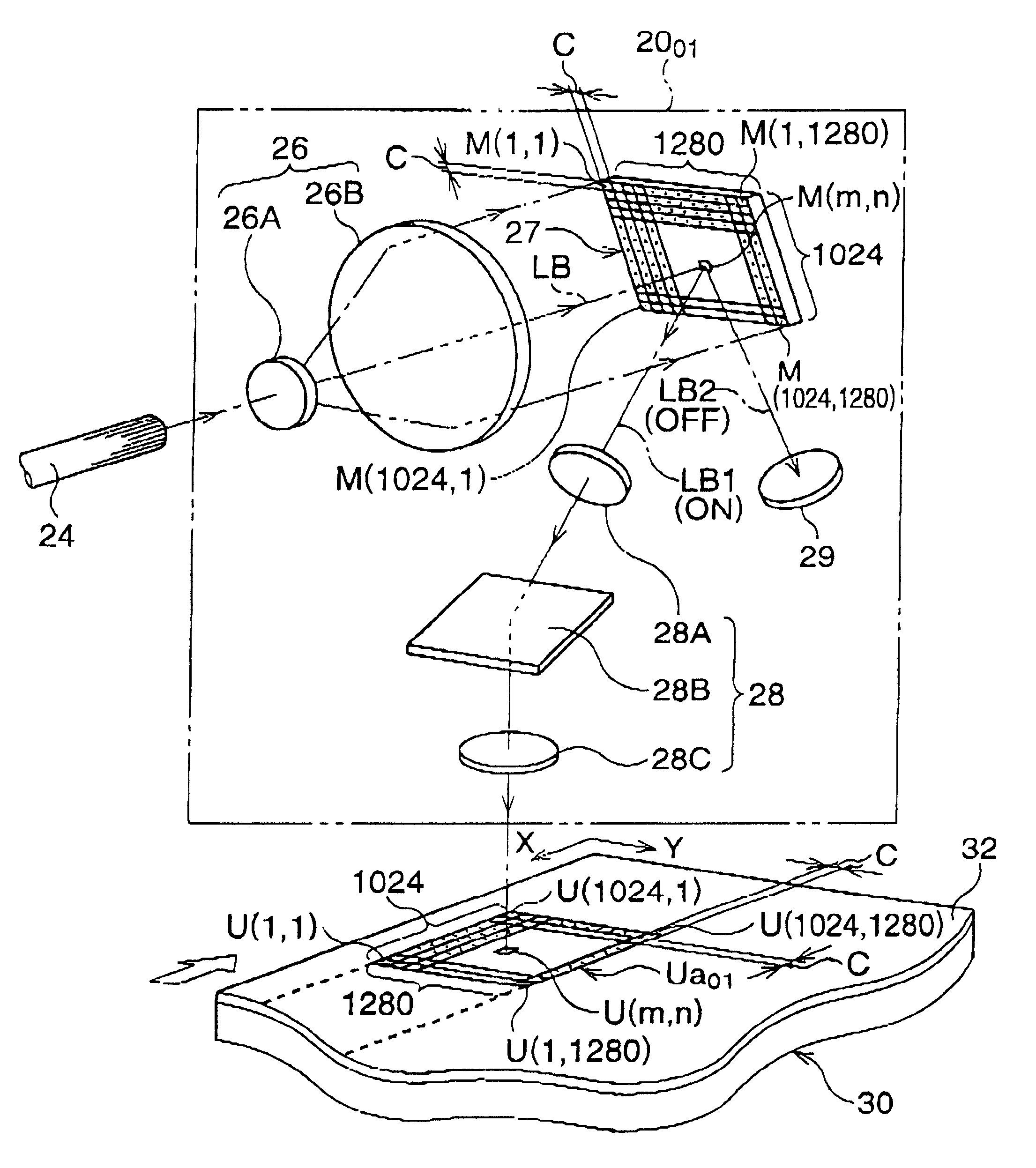

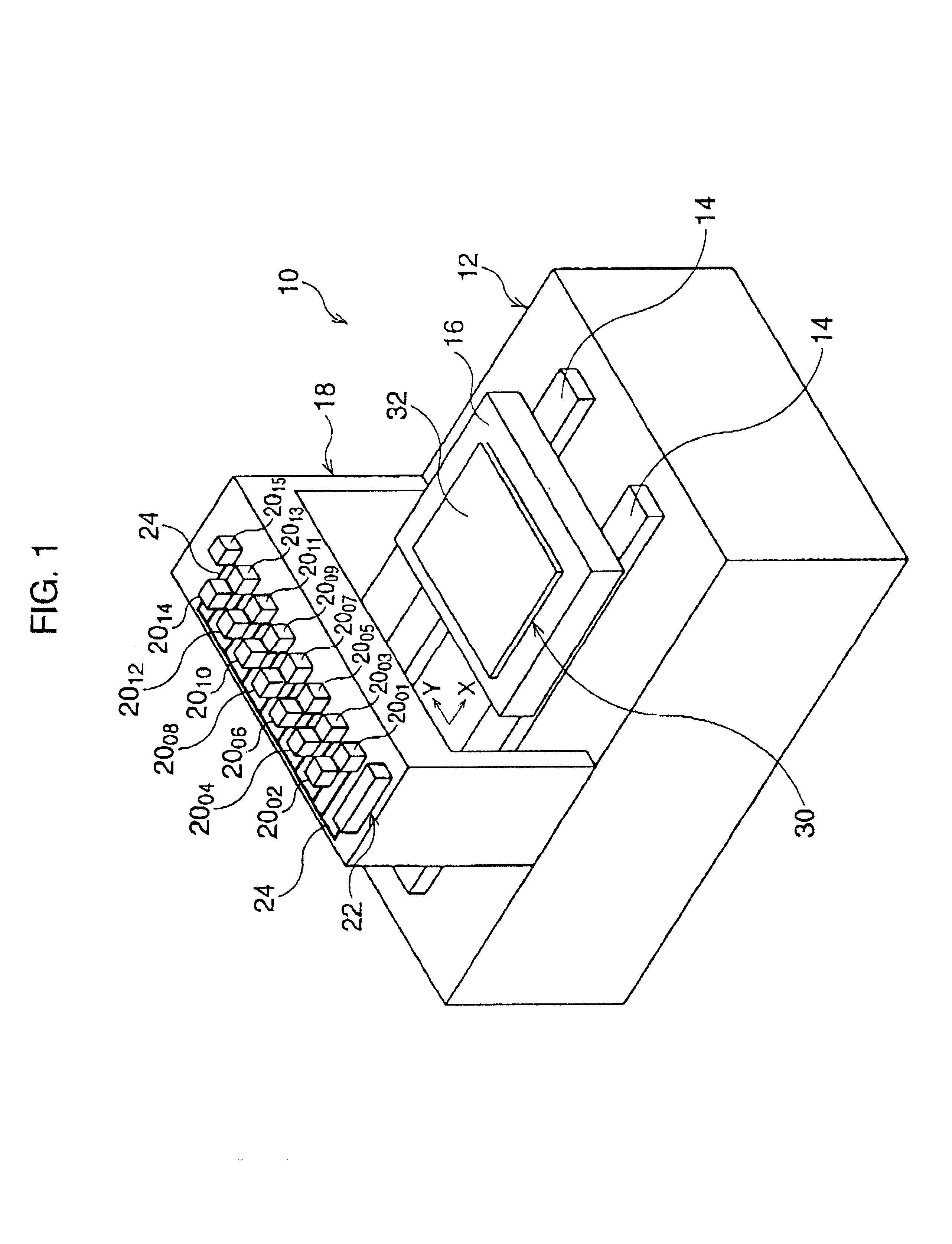

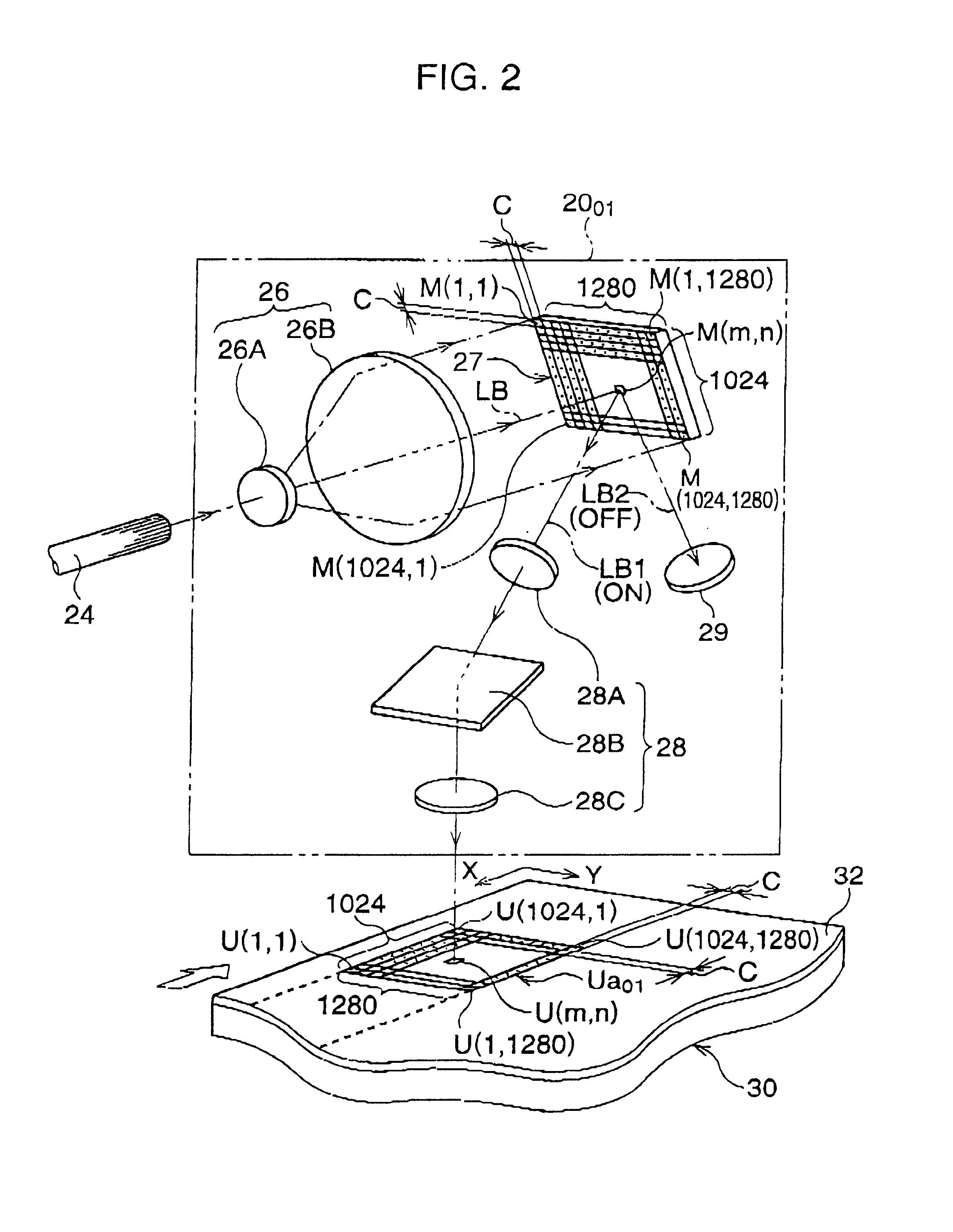

Multiple-exposure drawing apparatus and method thereof

ActiveUS6886154B2Drawn preciselyCharacter and pattern recognitionPhotomechanical exposure apparatusGratingComputer graphics (images)

A multi-exposure drawing apparatus for drawing a given pattern on a workpiece is provided. The apparatus uses an exposure unit with optical modulation elements arranged in a matrix. The apparatus comprises a first, second, and third memory, a coordinate transformation processor, a calculation processor, and an exposure-data generating processor. The first, second, and third memory respectively stores raster-data of the given pattern, first-coordinate data representing a position of each optical modulation element, and second-coordinate data representing a position of the exposure unit. The coordinate transformation is performed for the first-coordinate data. Address-data is calculated in accordance with a pixel size of the raster-data, and is based on the sum of the first and second coordinate data. Exposure-data generated by outputting the raster-data of the address-data is given to each of the optical modulation elements. The given pattern is drawn on the drawing surface as to the exposure-data.

Owner:ORC MFG

Method, apparatus and system for dynamic range estimation of imaged scenes

A method, apparatus, and system for dynamic range estimation of imaged scenes for automatic exposure control. For a given exposure time setting, certain areas of a scene may be brighter than what a camera can capture. In cameras, including those experiencing substantial lens vignetting, a gain stage may be used to extend dynamic range and extract auto-exposure data from the extended dynamic range. Alternatively, dynamic range can be extended using pre-capture image information taken under reduced exposure conditions.

Owner:MICRON TECH INC

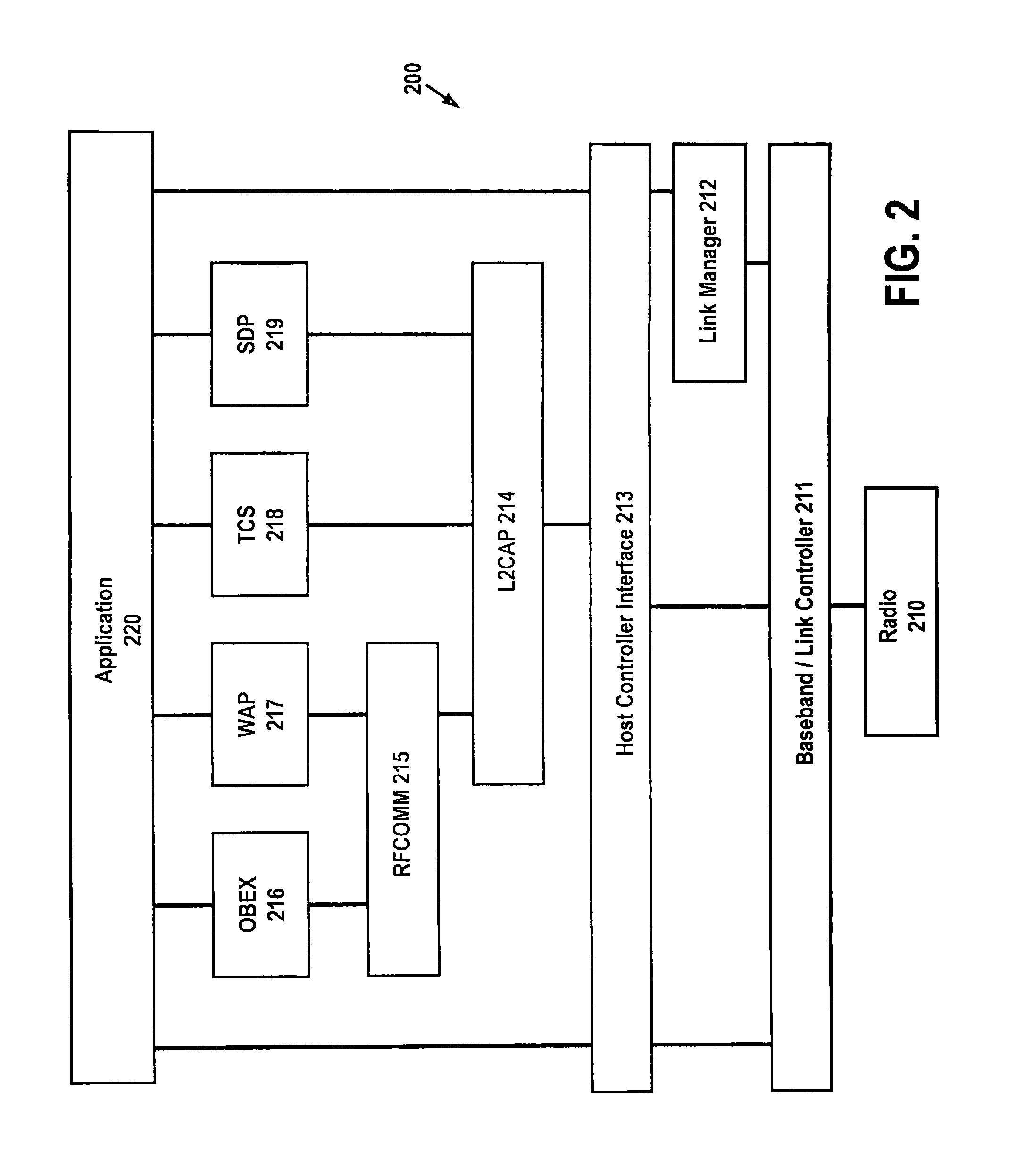

Systems and Methods for Presence Detection and Linking to Media Exposure Data

InactiveUS20130262184A1Maps/plans/chartsLocation information based servicePosition dependentBluetooth

A computer-implemented system, apparatus and method for monitoring media exposure data and correlating media exposure data to locations. Location data may be generated utilizing measurements of radio waves from WiFi and / or Bluetooth. Identification may also be transmitted when WiFi and / or Bluetooth transmission are received. As media is reproduced or received on / near a portable device, media exposure data is generated. Subsequent location data is monitored and processed to determine specific locations that may include commercial establishments. The locations are then correlated to the media exposure data to determine user actions related to media exposure.

Owner:THE NIELSEN CO (US) LLC

System and method for determining meter presence utilizing ambient fingerprints

Systems and methods are disclosed for providing portable device presence utilizing environmental ambient audio fingerprints. Portable devices provide media exposure data and environmental ambient fingerprints to a processing device, where the environmental ambient signatures provide at least one characteristic of the ambient audio surrounding each portable device. The environmental ambient signatures are then processed to determine if they match. Portable devices associated with matching signatures are identified. Ambient fingerprints may also be used to establish a logical location where media exposure took place. The ambient signatures are alternately combined with monitored data to provide more robust data sets for contextual processing.

Owner:THE NIELSEN CO (US) LLC

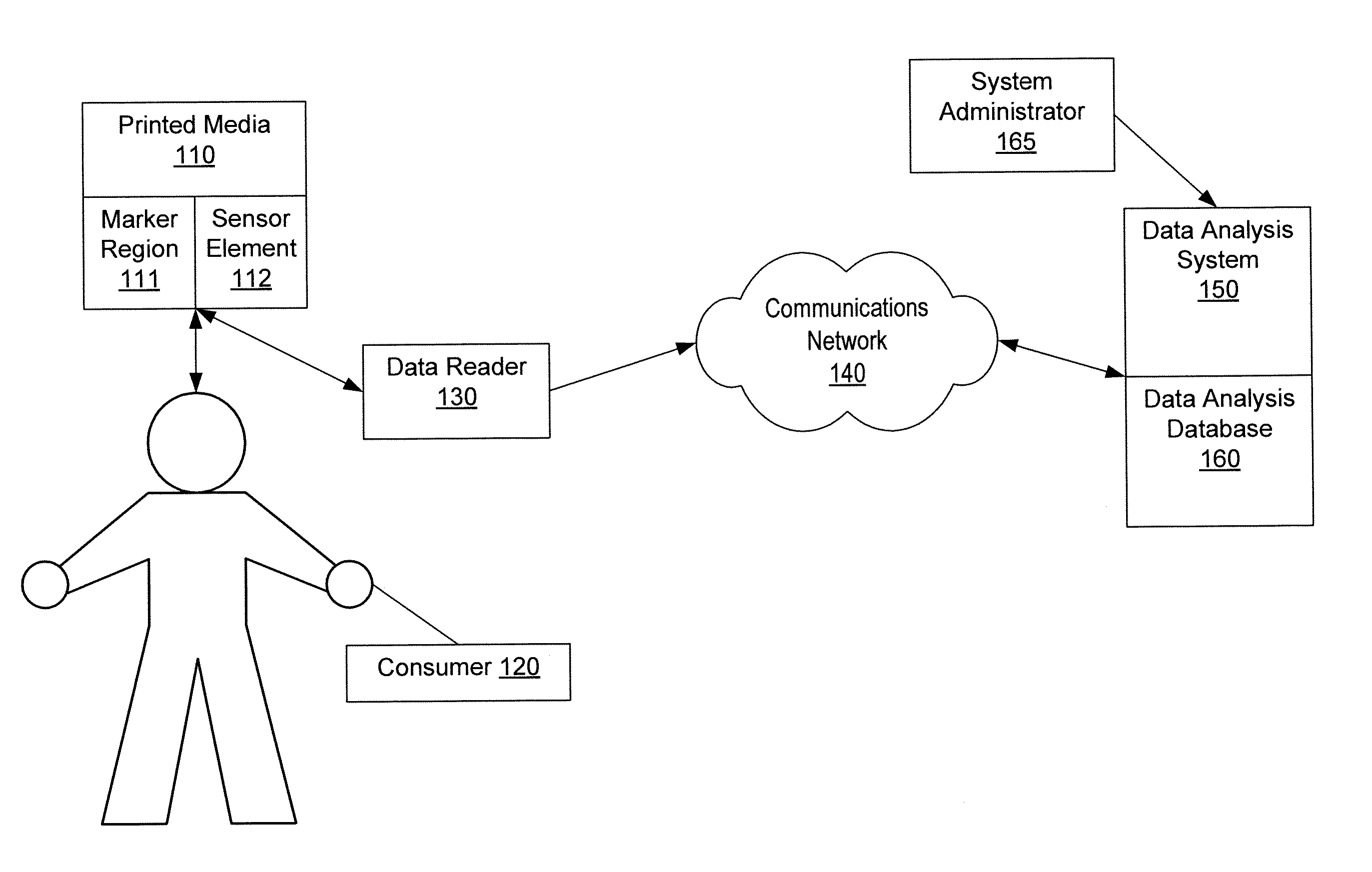

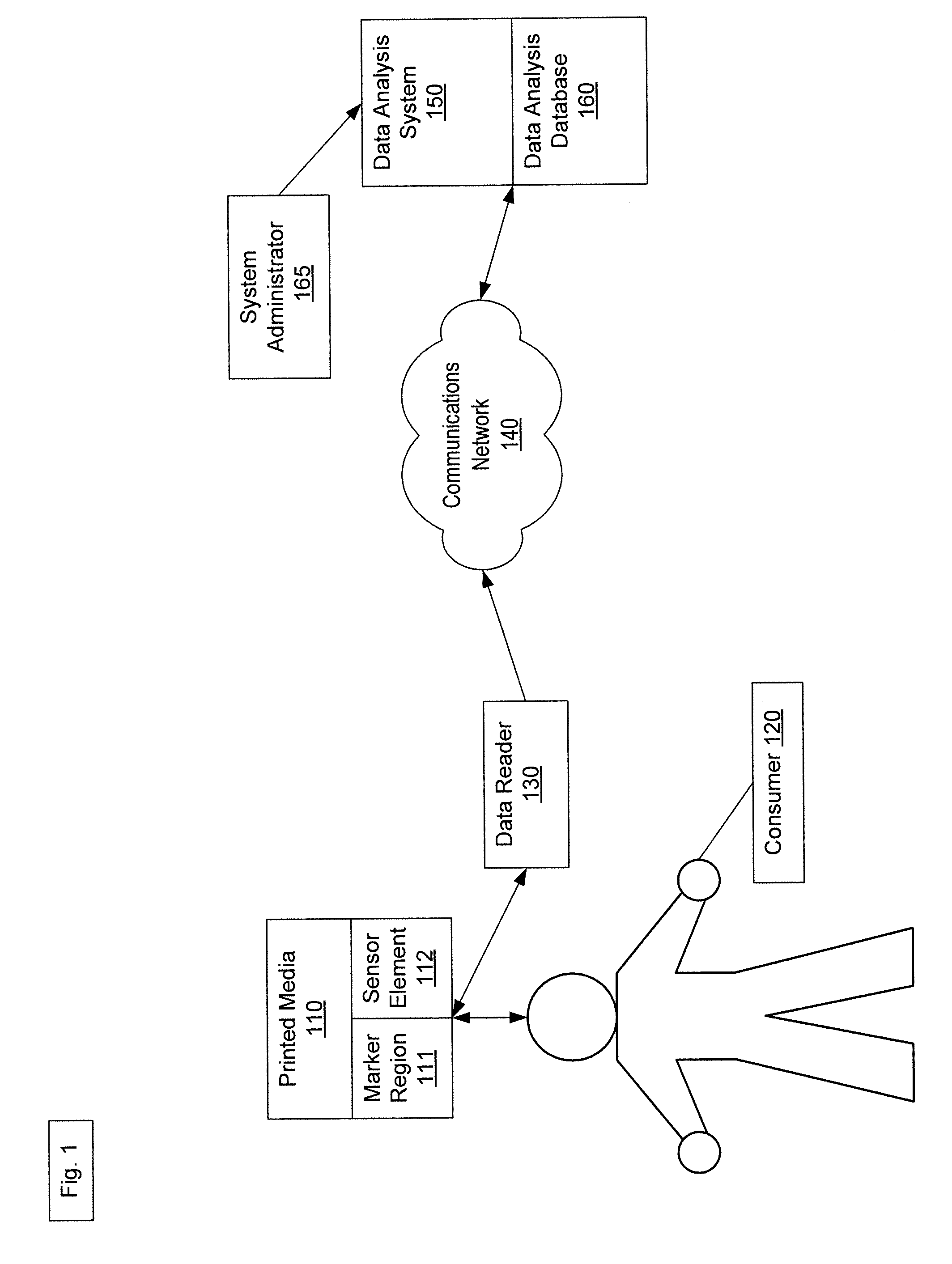

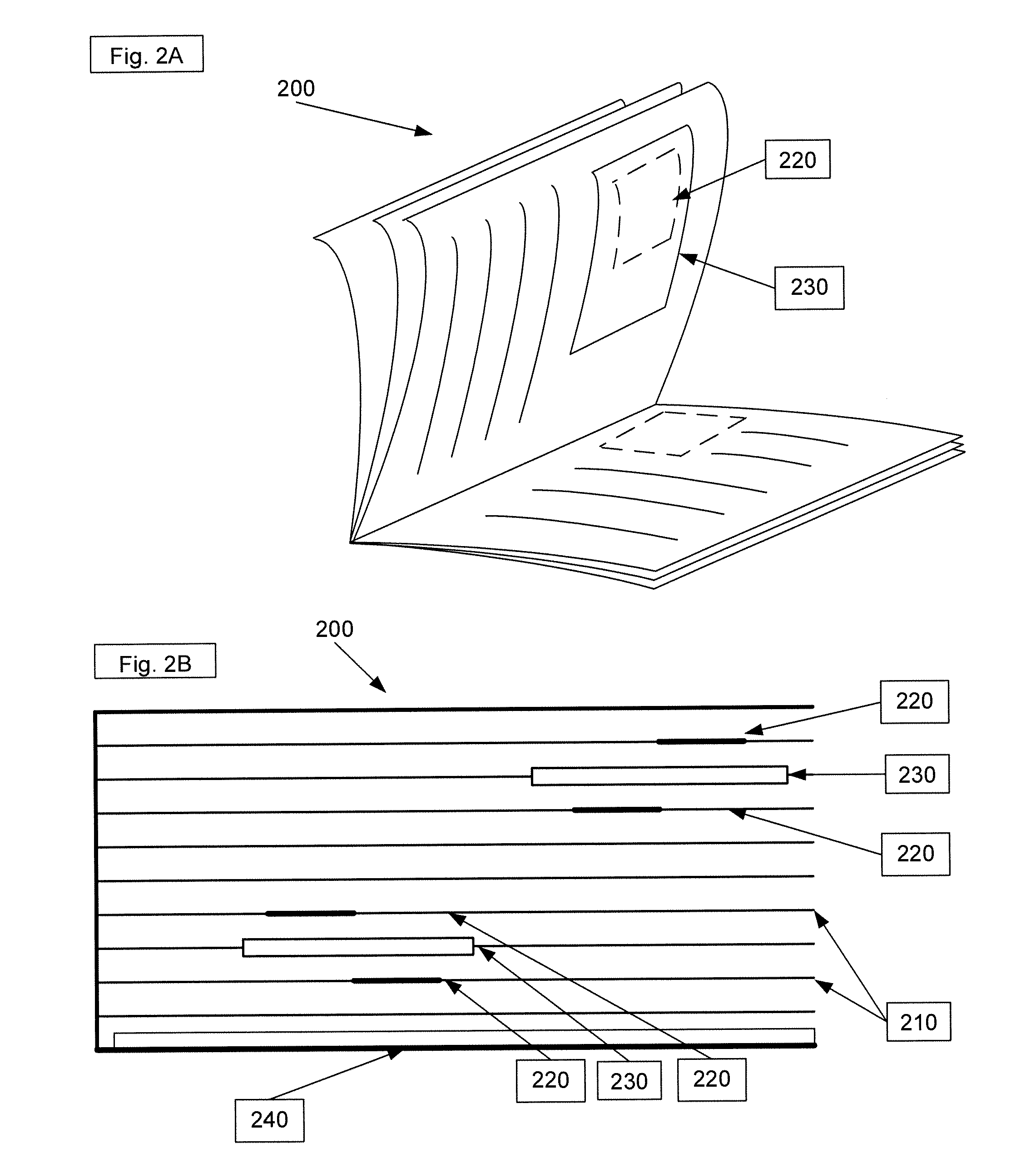

System and method for rfid-based printed media reading activity data acquisition and analysis

InactiveUS20070138251A1Maximum flexibilityEliminate useCo-operative working arrangementsSensing record carriersData acquisitionComputer science

The subject invention provides a means of automatically detecting and recording a person's use of magazines, i.e. printed media exposure, for the purpose of market research. The present invention comprises one or more electrically conductive marker regions applied to certain specific locations on one or more magazine pages. In one general embodiment, the presence and relative separation of the marker regions are detected by a capacitive sensors and electronic device that stores, processes and communicates the data wirelessly to an external device. In another embodiment, a passive chip less tag is used to indirectly measure the change in conductivity of the conductive regions caused by prolonged exposure to air or light. Exemplary methods are described for acquiring readership and exposure data using the present invention.

Owner:GFK US LLC

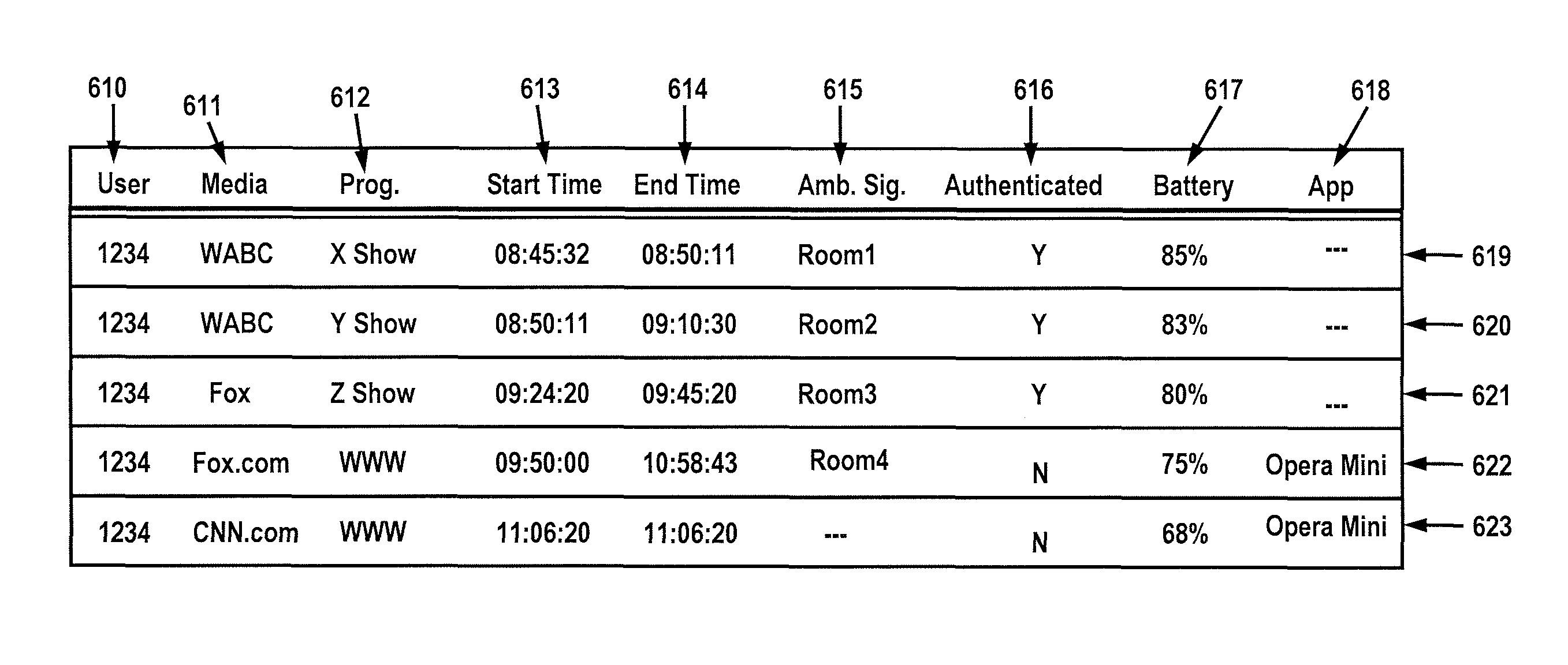

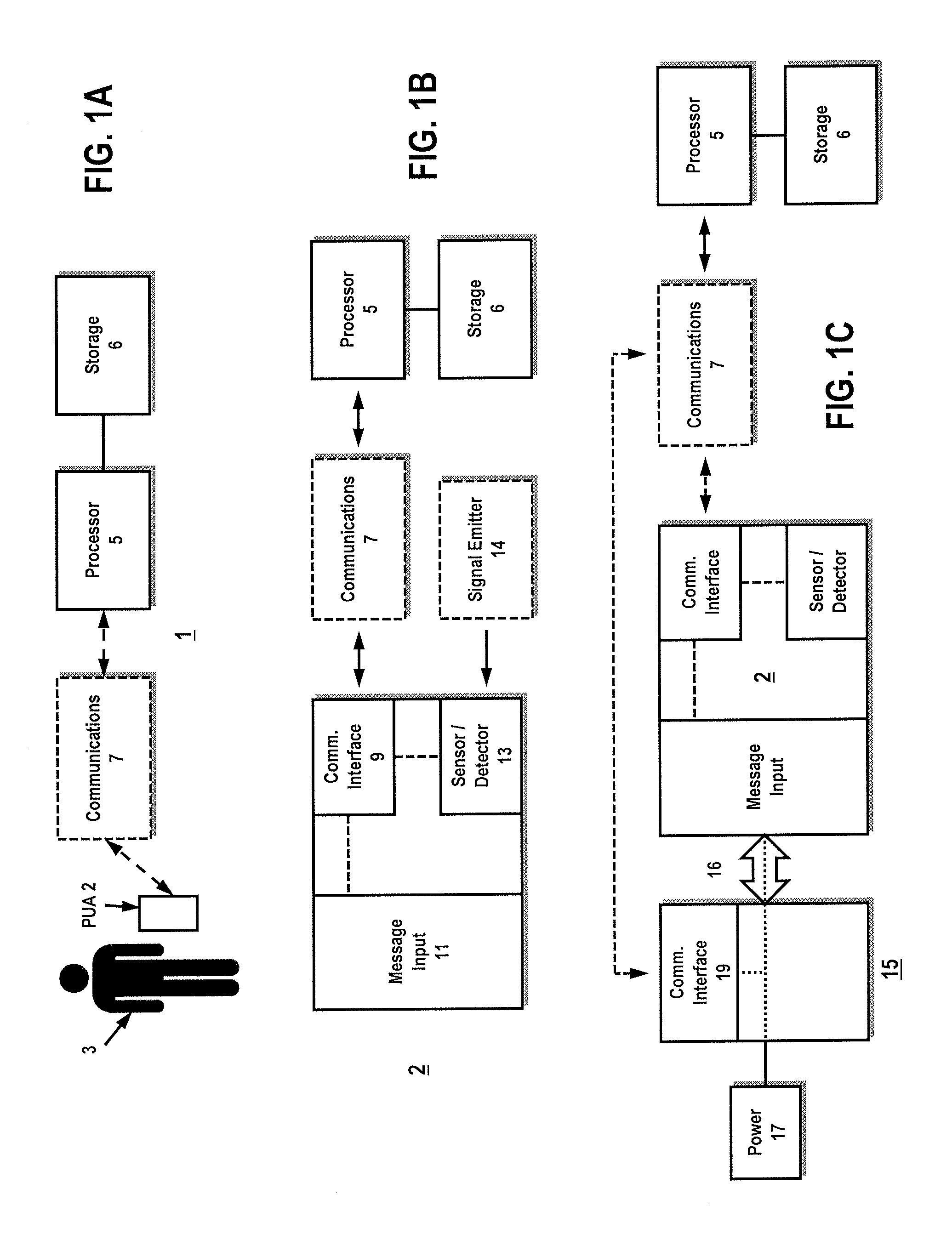

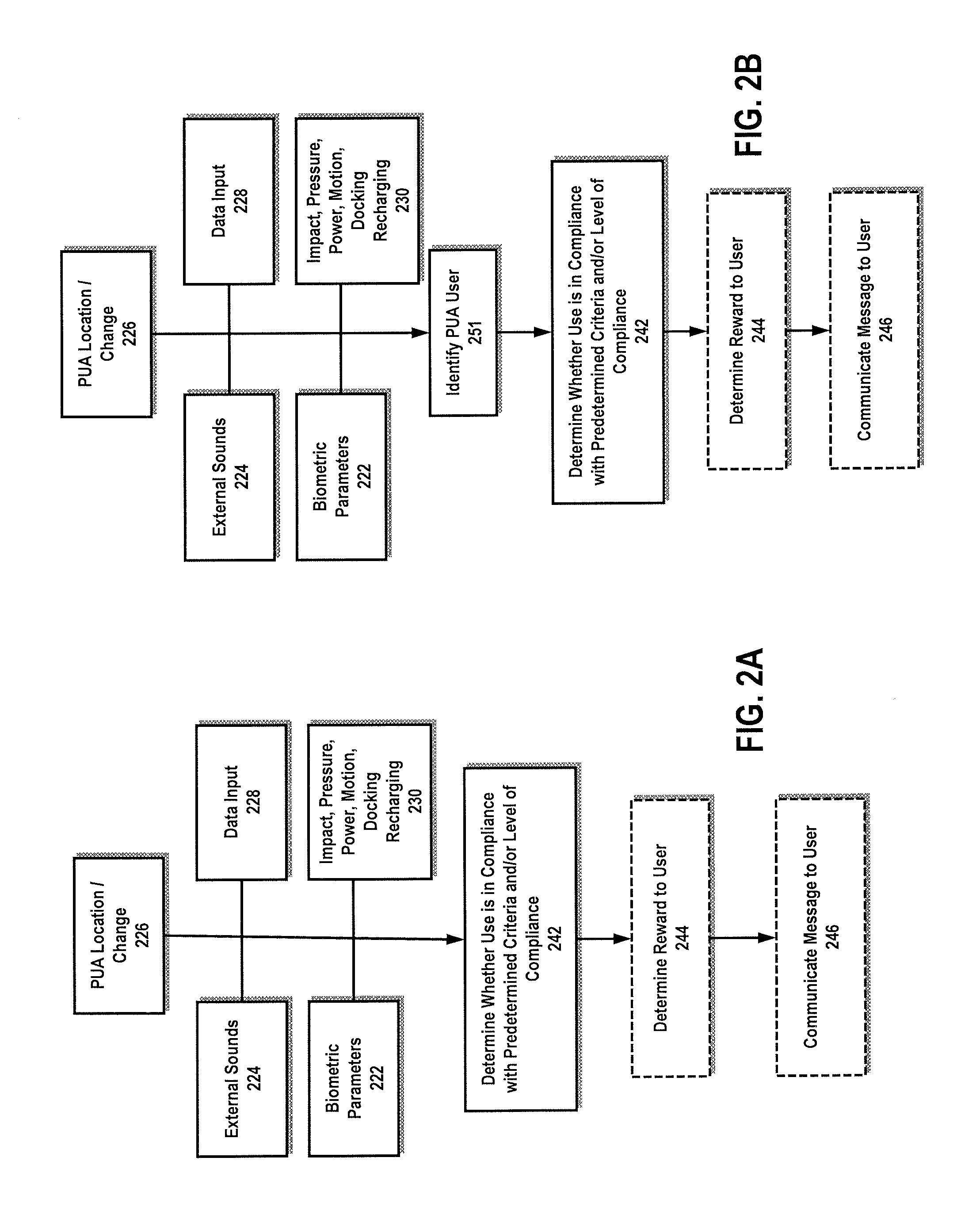

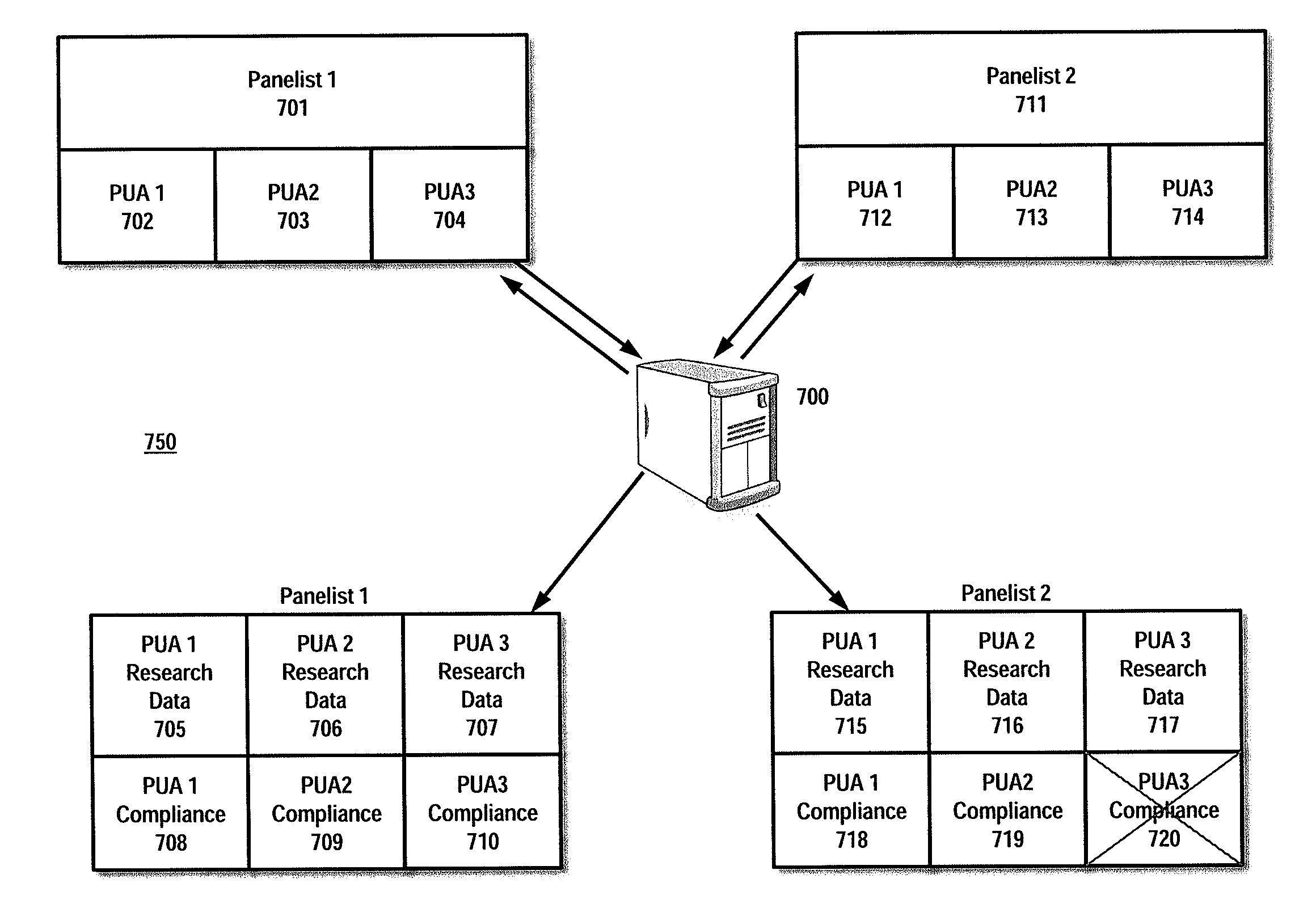

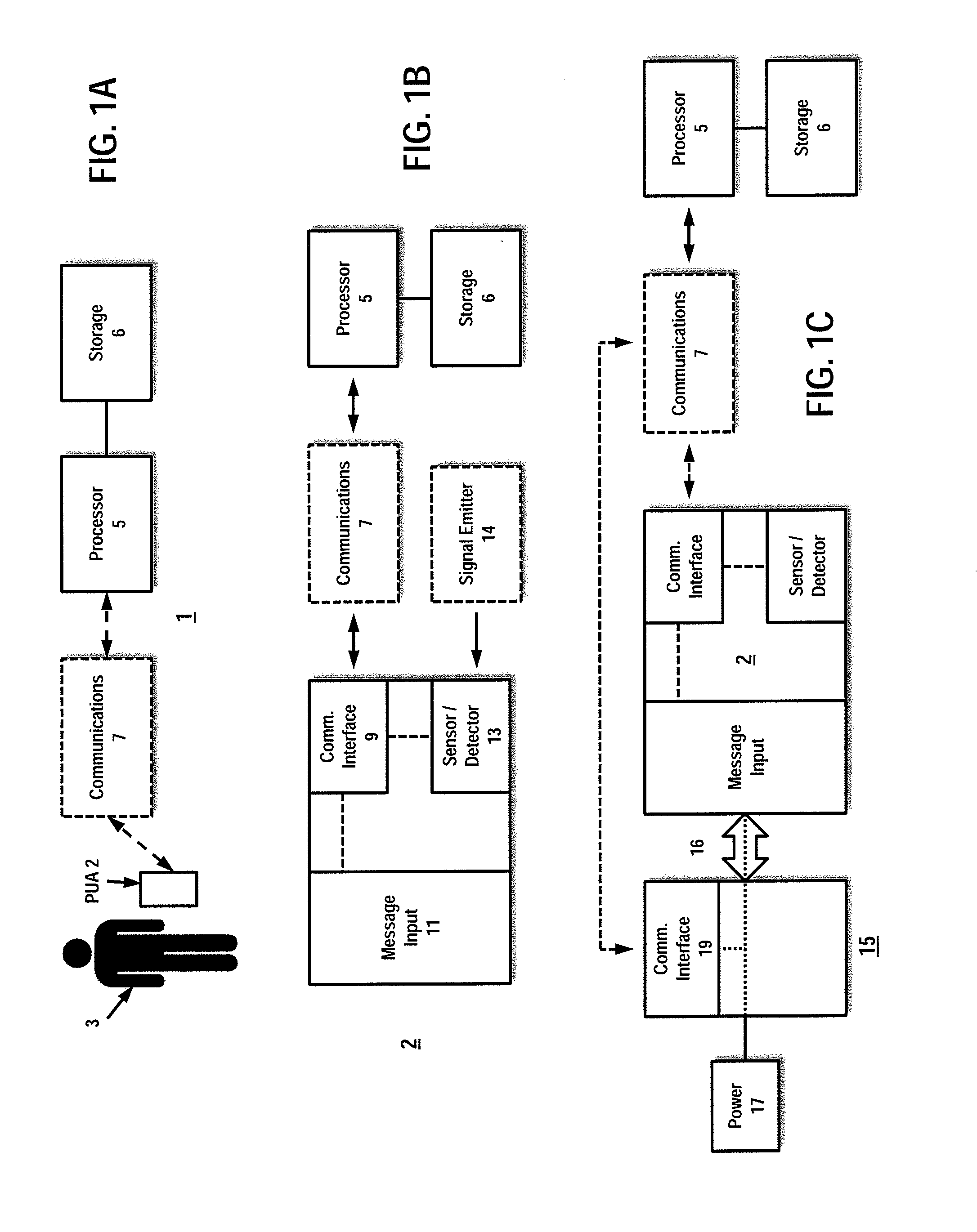

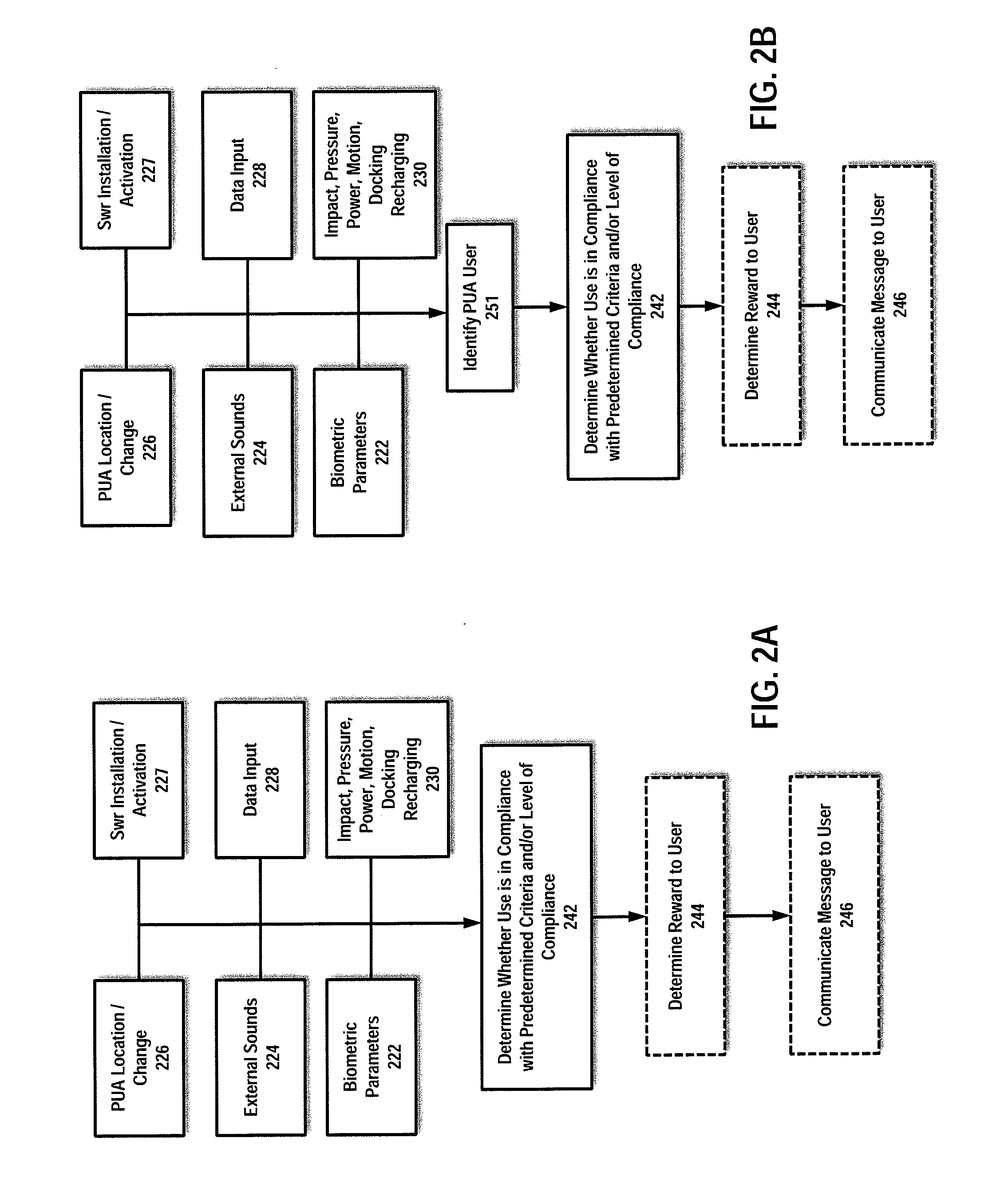

System and method for determining device compliance and recruitment

InactiveUS20120278377A1Multiple digital computer combinationsMarket data gatheringResearch dataUser equipment

Systems and methods are disclosed for processing data provided by portable user appliances (PUAs) that are configured to provide research data that includes media exposure data. Each of the PUAs include a detector or sensor that reports a configuration and / or usage of the PUA. The configuration and / or usage is processed to determine if the PUA is in compliance with a predetermined usage criteria. Under one example, each panelist is equipped with a plurality of PUAs such as smart phones, computers or other devices, and compliance is measured for each panelist across the plurality of PUAs while research data is collected.

Owner:THE NIELSEN CO (US) LLC

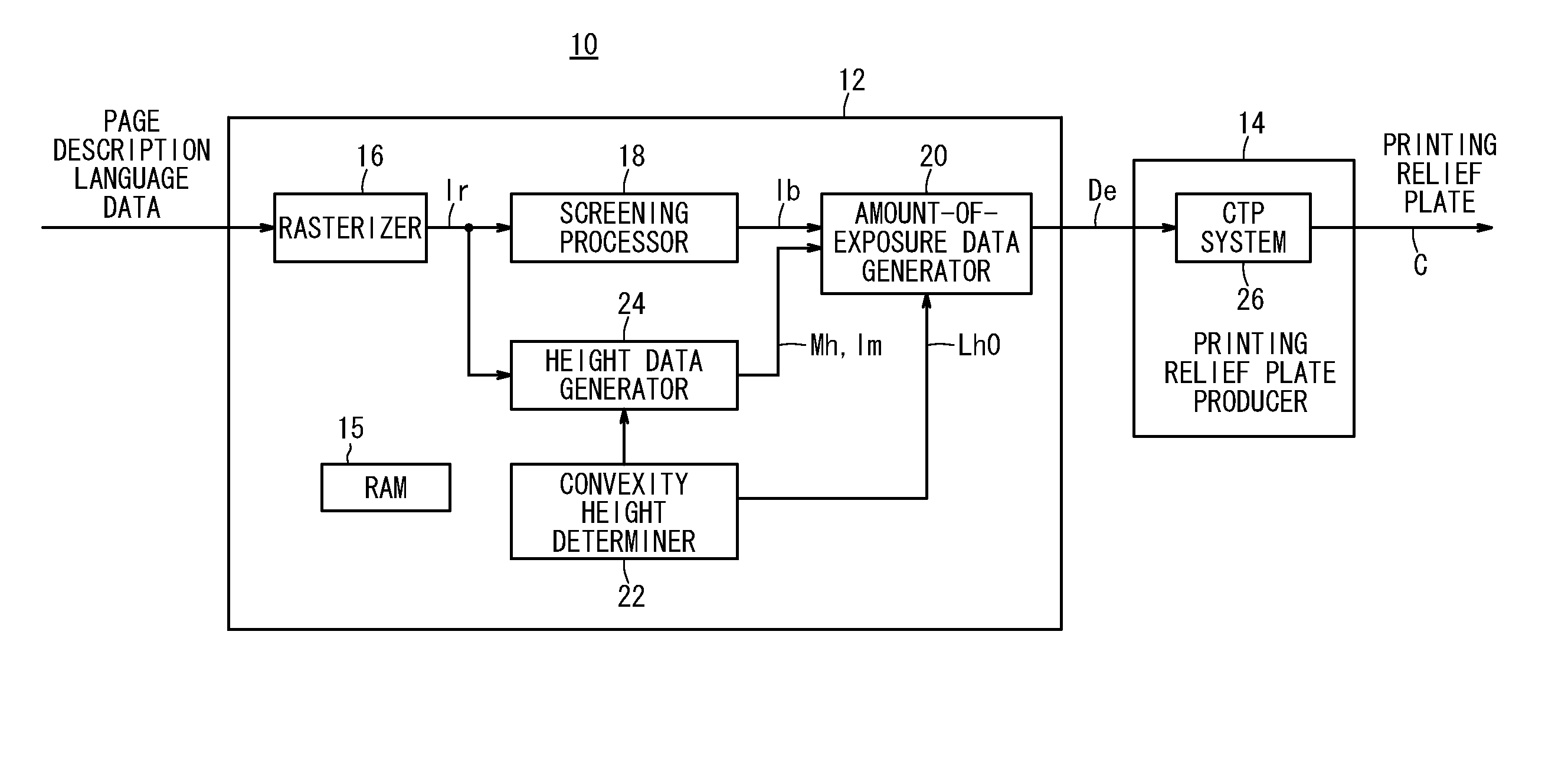

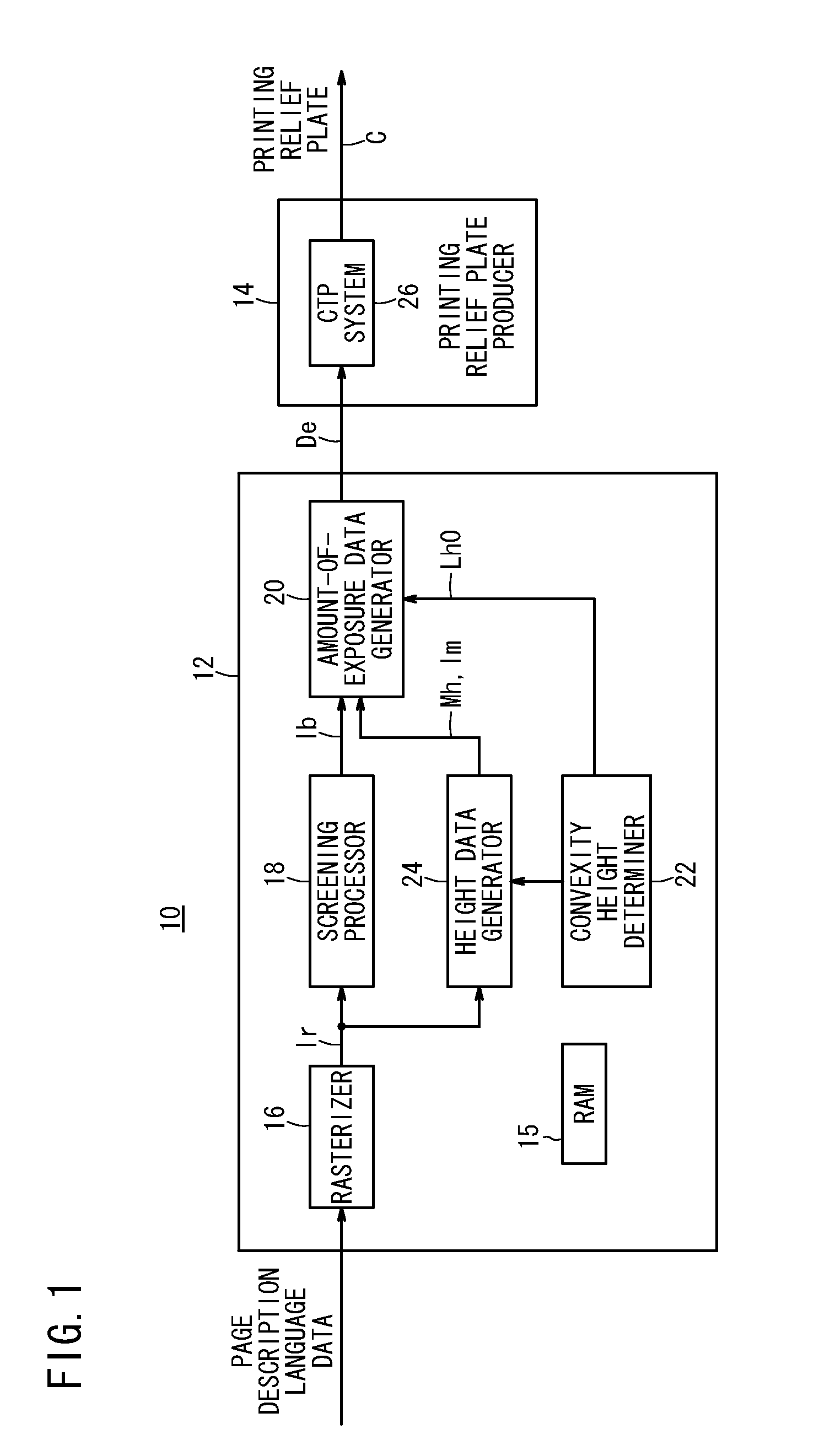

Printing relief plate producing apparatus, system, method, and recording medium

InactiveUS20110255134A1High printing densityHigh densityVisual presentationOther printing apparatusGratingComputer graphics (images)

Height conversion matrices for determining heights of halftone dot convexities are generated based on raster image data. Based on the height conversion matrices and binary image data, amount-of-exposure data are generated in order to produce a printing relief plate in which the halftone dot convexities have heights at a plurality of height levels in a screen tint region, which is formed based on the binary image data. Based on the amount-of-exposure data, a printing plate material is exposed to a light beam, thereby producing a printing relief plate.

Owner:FUJIFILM CORP

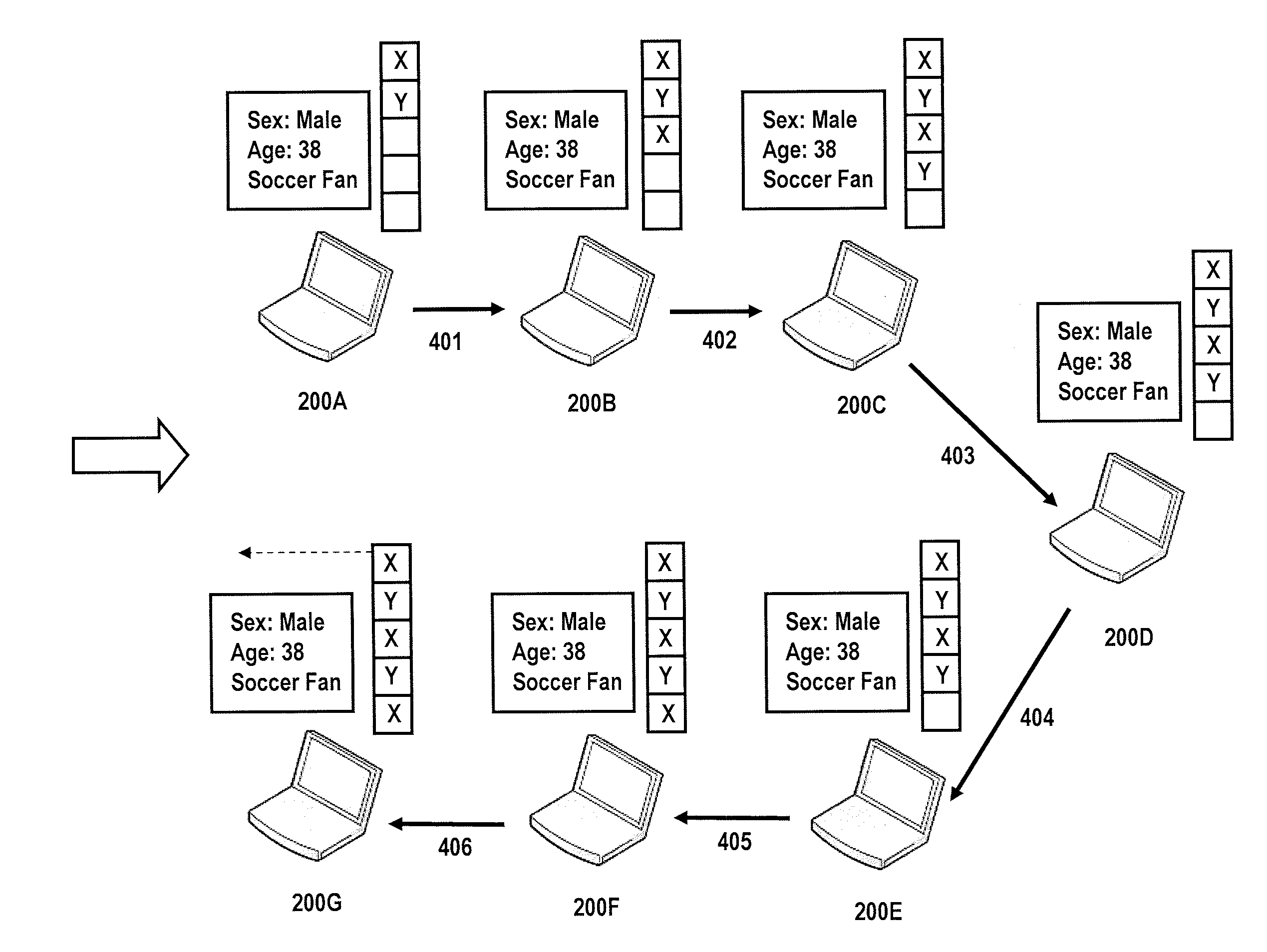

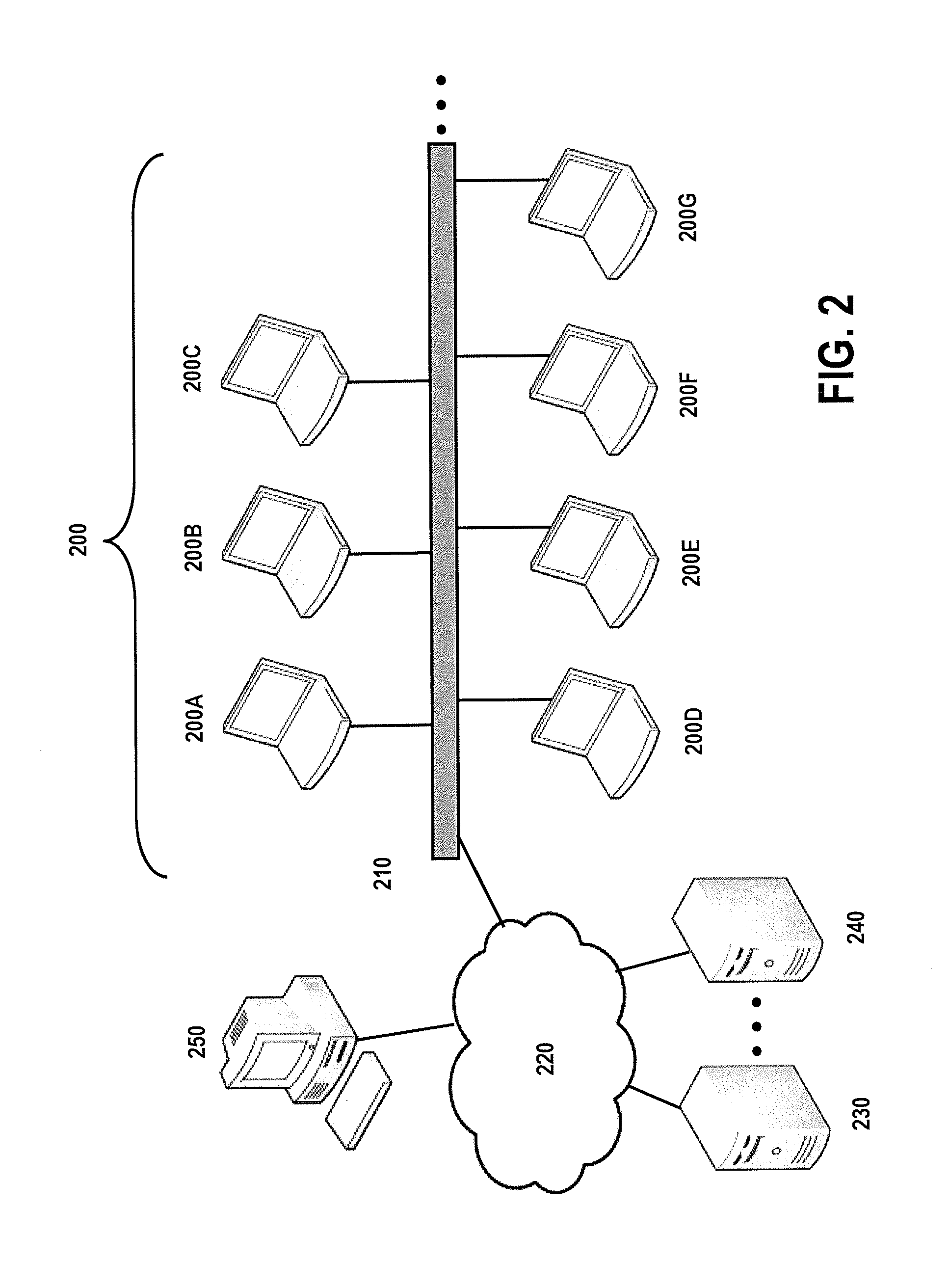

System and Method for Peer-to-Peer Distribution of Media Exposure Data

InactiveUS20130232198A1Privacy protectionReliable resultsMarket predictionsTransmissionObfuscationInternet privacy

Systems and methods for operating an anonymous peer-to-peer (“P2P”) privacy panel for audience measurement is disclosed. A plurality of processing devices are configured to record and process research data pursuant to a research operation. Each of the users associated with each processing devices provide user data to a central site, where the user data includes demographic information, previous media exposure data, and other data. In accordance with user data, a customized P2P network is created where media exposure data including audio codes, signatures and data objects is obfuscated and communicate among portable devices in the network. By utilizing a P2P network, together with obfuscation techniques, panelist privacy is greatly increased.

Owner:ARBITRON

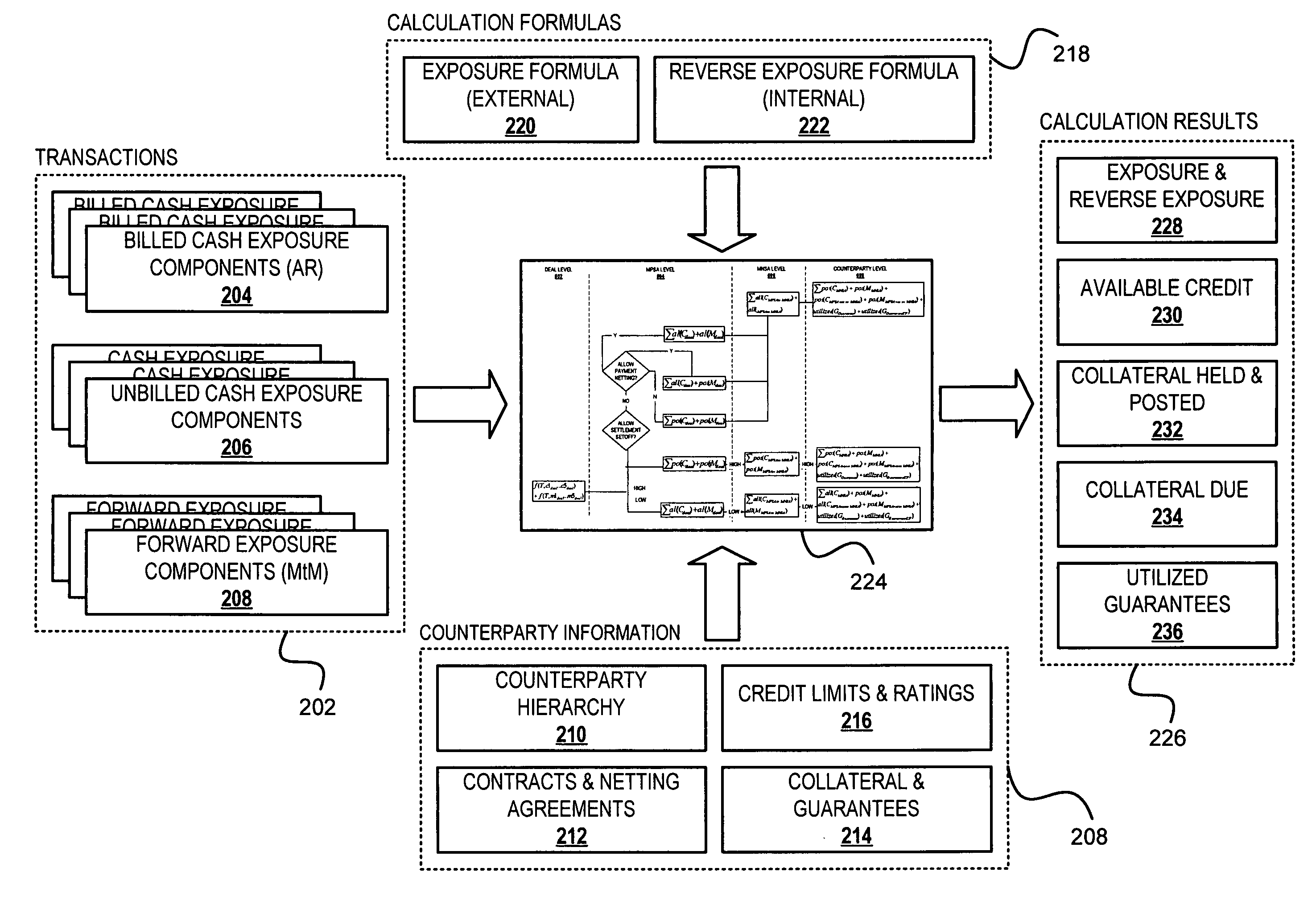

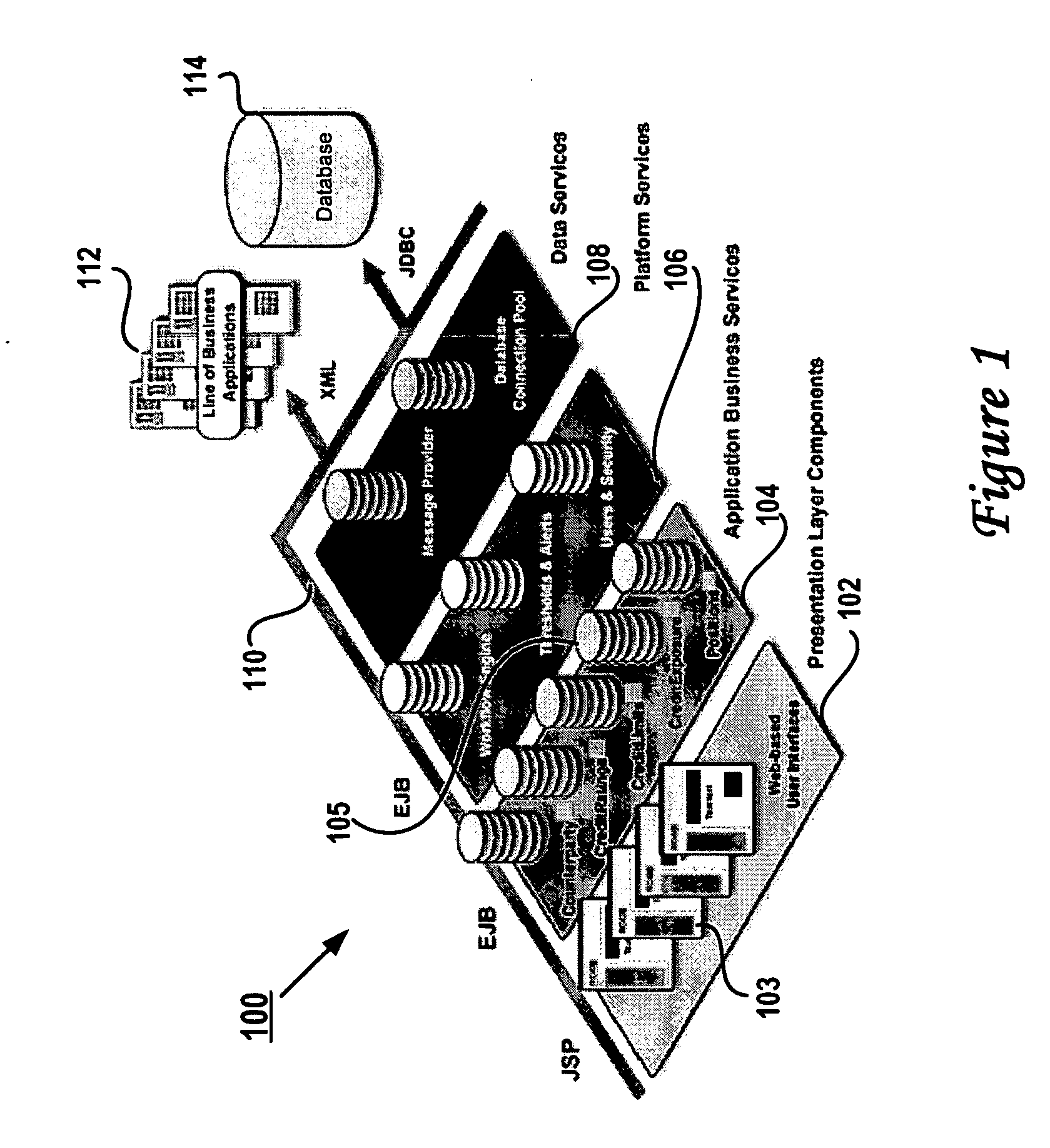

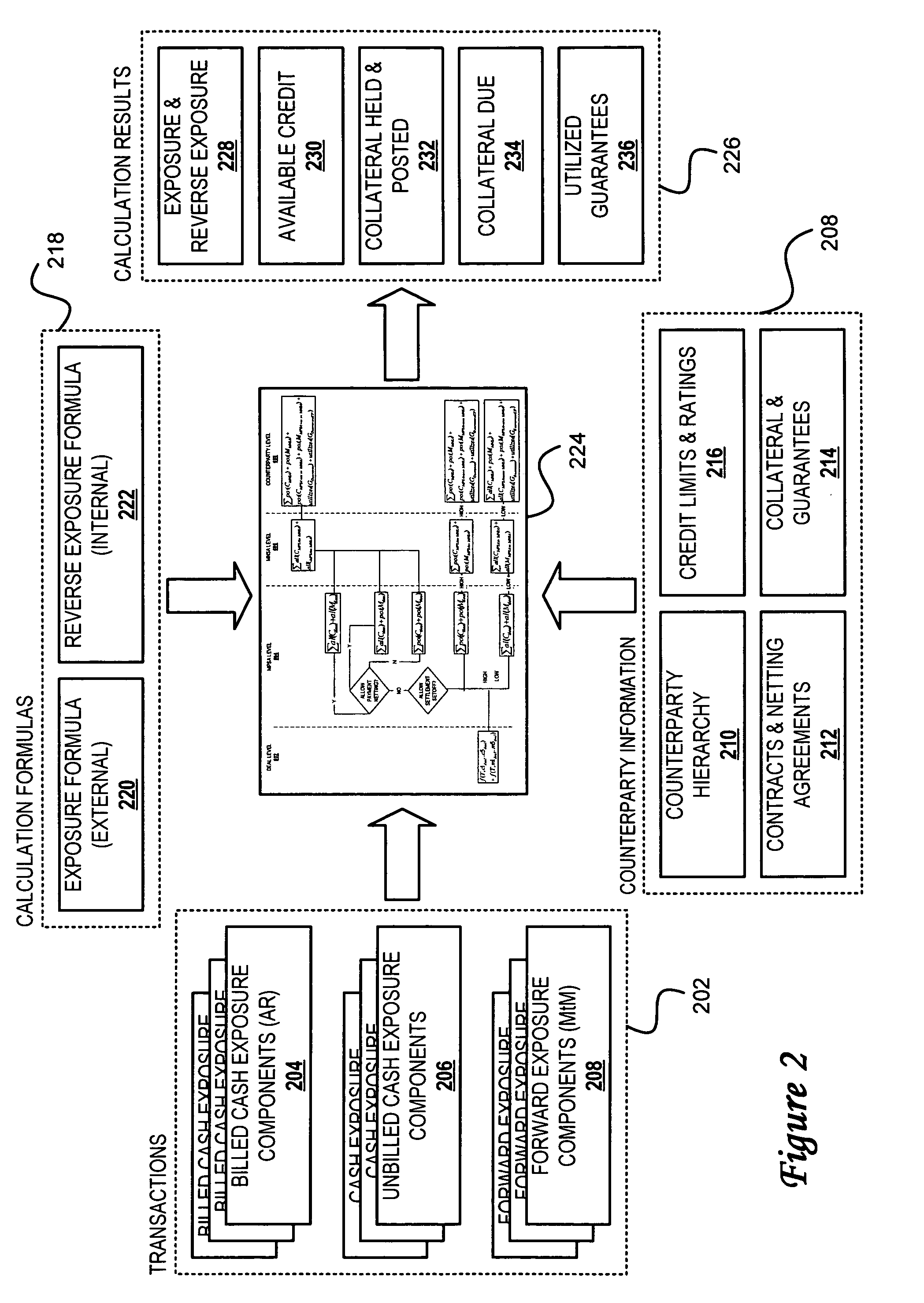

Method, system and program for credit risk management utilizing credit exposure

Software aggregates and integrates credit exposure data across accounting, trading and operational systems within an energy trading organization. A comprehensive model of exposure to all counterparties, across all of their divisions and subsidiaries, is then assembled, enabling the creation of a hierarchical view of each counterparty that models its real-world parent-child relationships, and taking into account netting, setoff, and margin requirements, collateral requirements and contract terms, internal and external views of exposure and liquidity, and risk concentrations based on both system and user-defined risk categories. After aggregating the exposure information, credit, transactions, risk and other properties are determined at any level in the hierarchy and then the system presents a comprehensive, detailed, real-time, enterprise-wide view of current exposure, collateral requirements and outlays for both a company and its counterparties. Walkforward views of potential credit exposure taking into account current and future prices and volumes are also provided.

Owner:ROME CORP

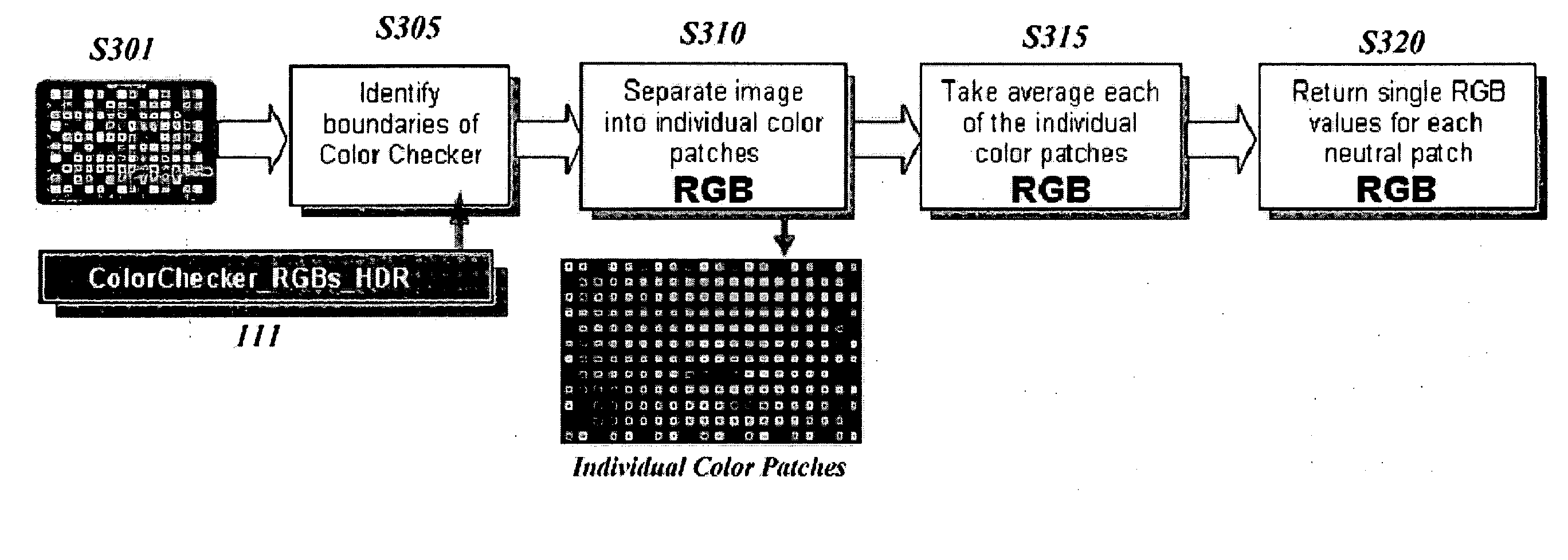

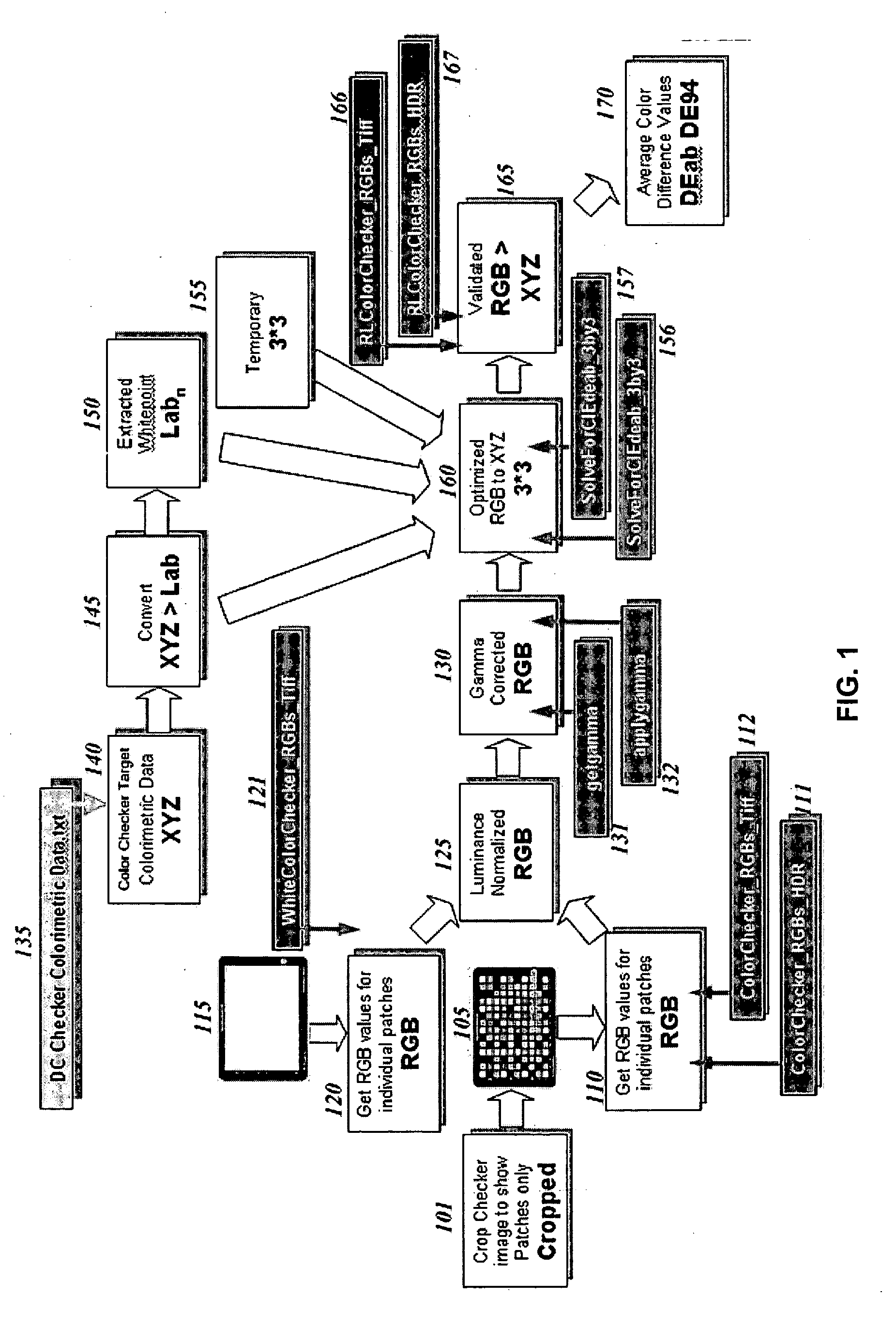

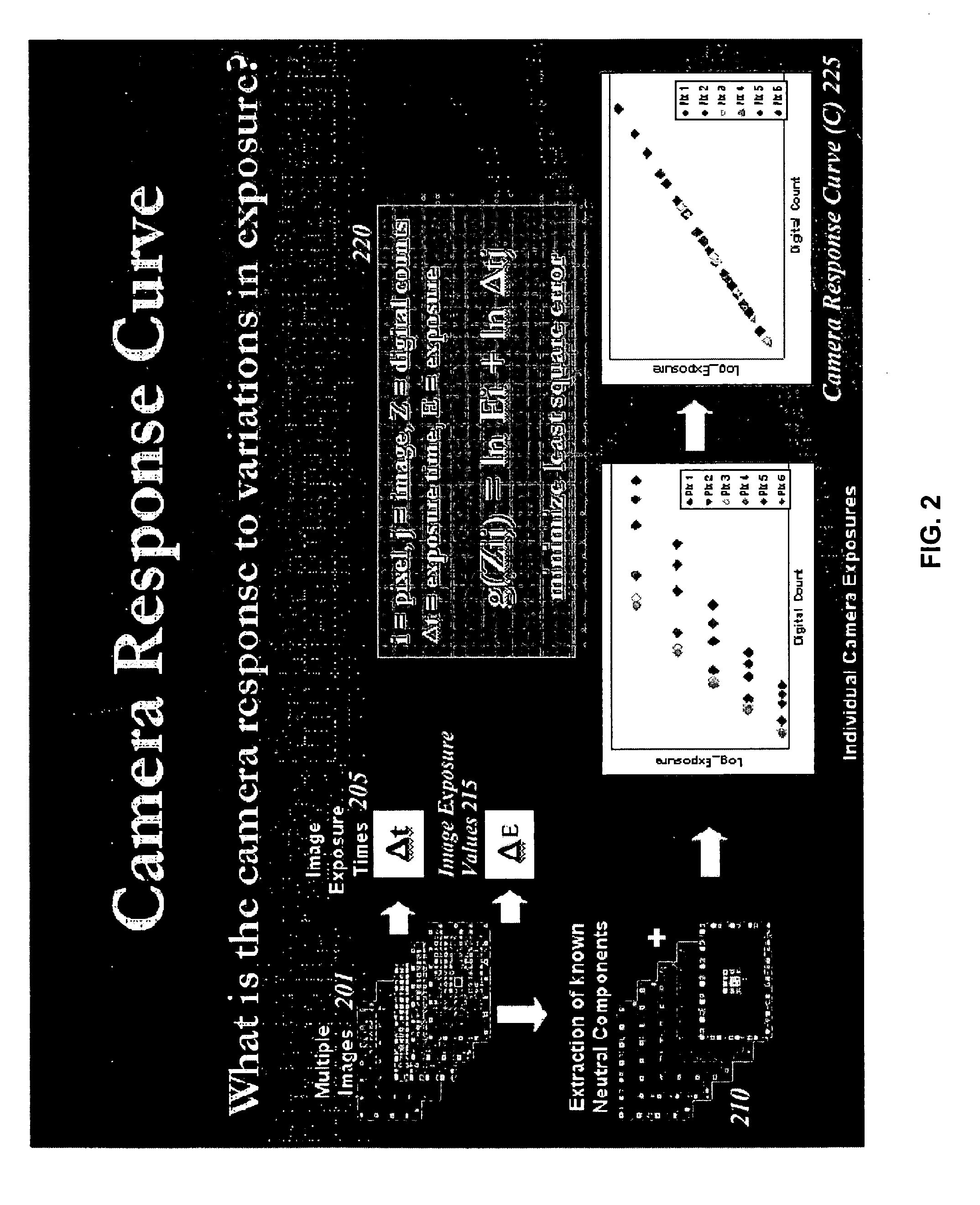

Color characterization of high dynamic range image capture devices

InactiveUS20070070364A1Minimizing least square errorAccurate estimate of neutralityTelevision system detailsDigitally marking record carriersExposure valueColorChecker

Color characterization of a high dynamic range (HDR) image capture device is provided. Color checker image data of a color checker at multiple exposures is obtained. Color values for neutral patches and exposure values are extracted. A colorimetrically accurate response curve is determined based on the neutral patch color values and the exposure values. An optimized transformation associated with the device is derived through gamma curve compensation based on the neutral patch data and comparison of color values of the compensated image with known color values of the color checker. A calorimetrically accurate HDR image is generated from scene image data of a scene captured by the device at multiple exposures through extraction of exposure data, modification of color values based on the colorimetrically accurate response curve and the exposure data, averaging the modified color values, and transformation of the averaged color values based on the optimized transformation.

Owner:CANON KK

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com