Patents

Literature

225results about "Financial management" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

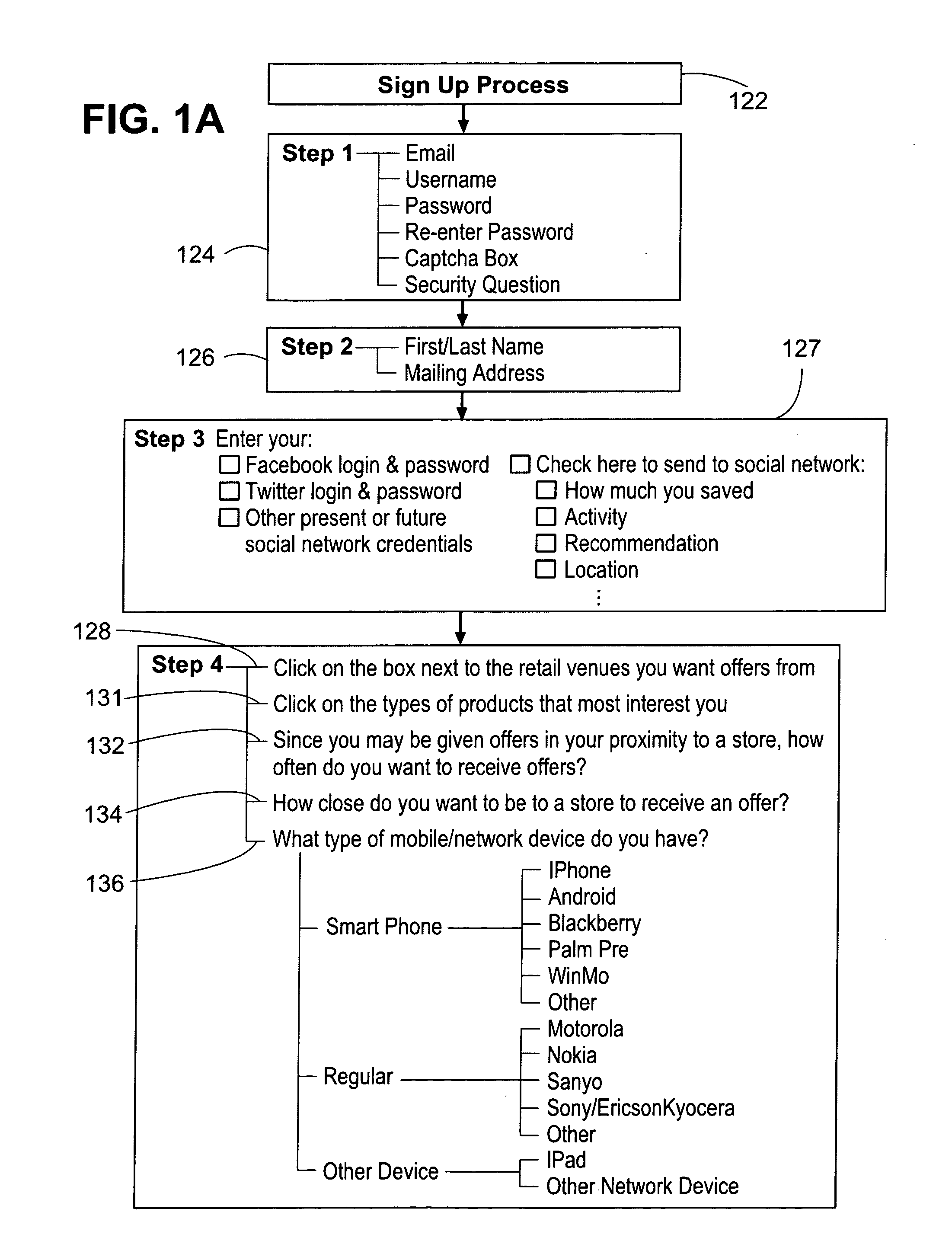

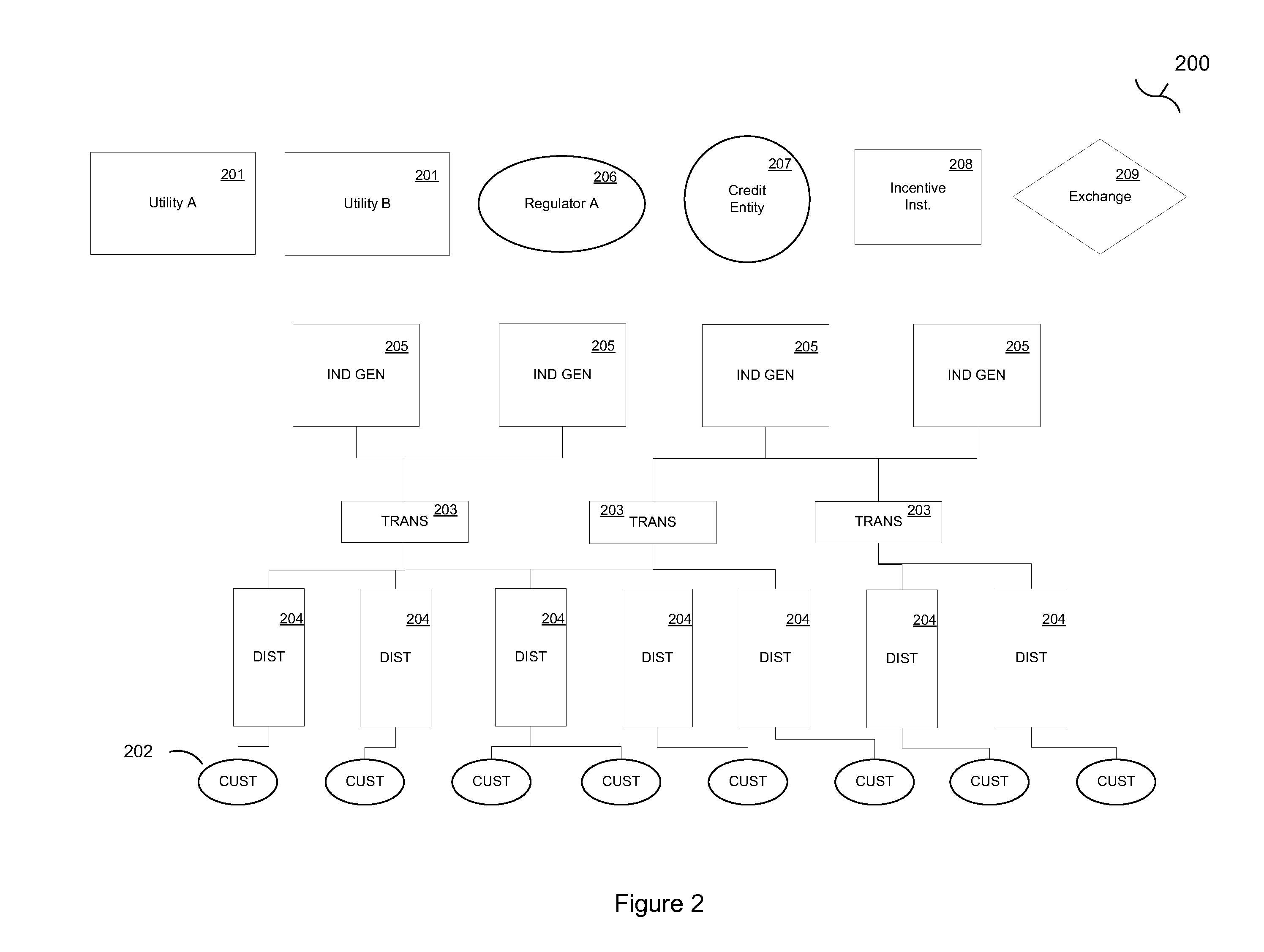

System and method for participation in energy-related markets

A multidimensional energy decision system, comprising a plurality of server systems, including at least a statistics server and an interface adapted to receive and send digital information from at least a client system, and further adapted to optionally communicate with the digital exchange via a packet-based data network, wherein the multidimensional energy decision system periodically optimizes operational parameters of client system for a specific time period and a specific energy asset from client system based on forecasted conditions, and directly, or upon decision confirmation from a client system, procures or makes dispatchable energy resources, related externalities, or related derivative financial products, available to a digital exchange or other parties, wherein upon the purchase of a listed asset by another party or across digital exchange, implements dispatch procedures to satisfy the issued contract and, optionally, provides monitoring and verification of performance, is disclosed.

Owner:CRABTREE JASON +6

System and method for managing energy resources based on a scoring system

Owner:CRABTREE JASON +3

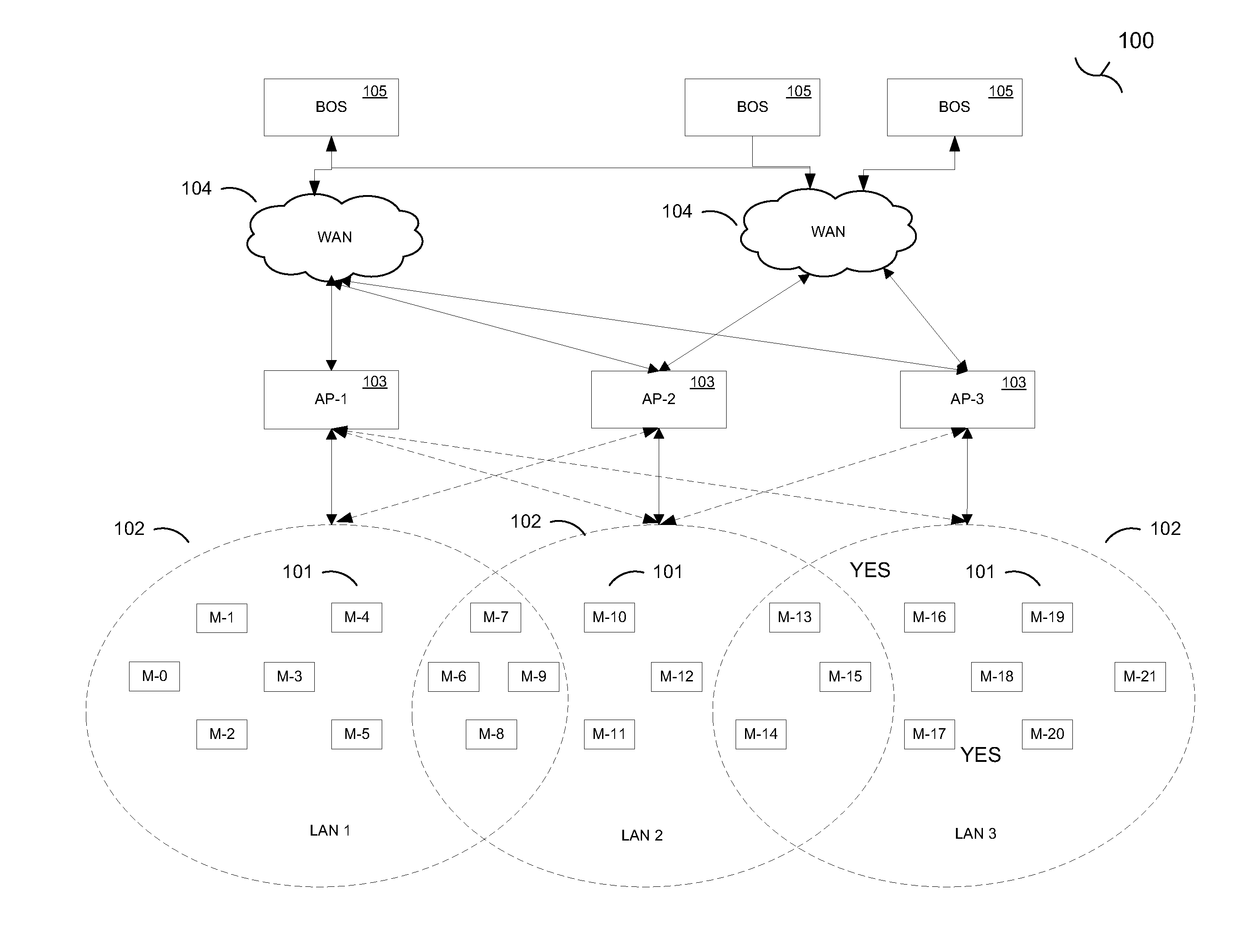

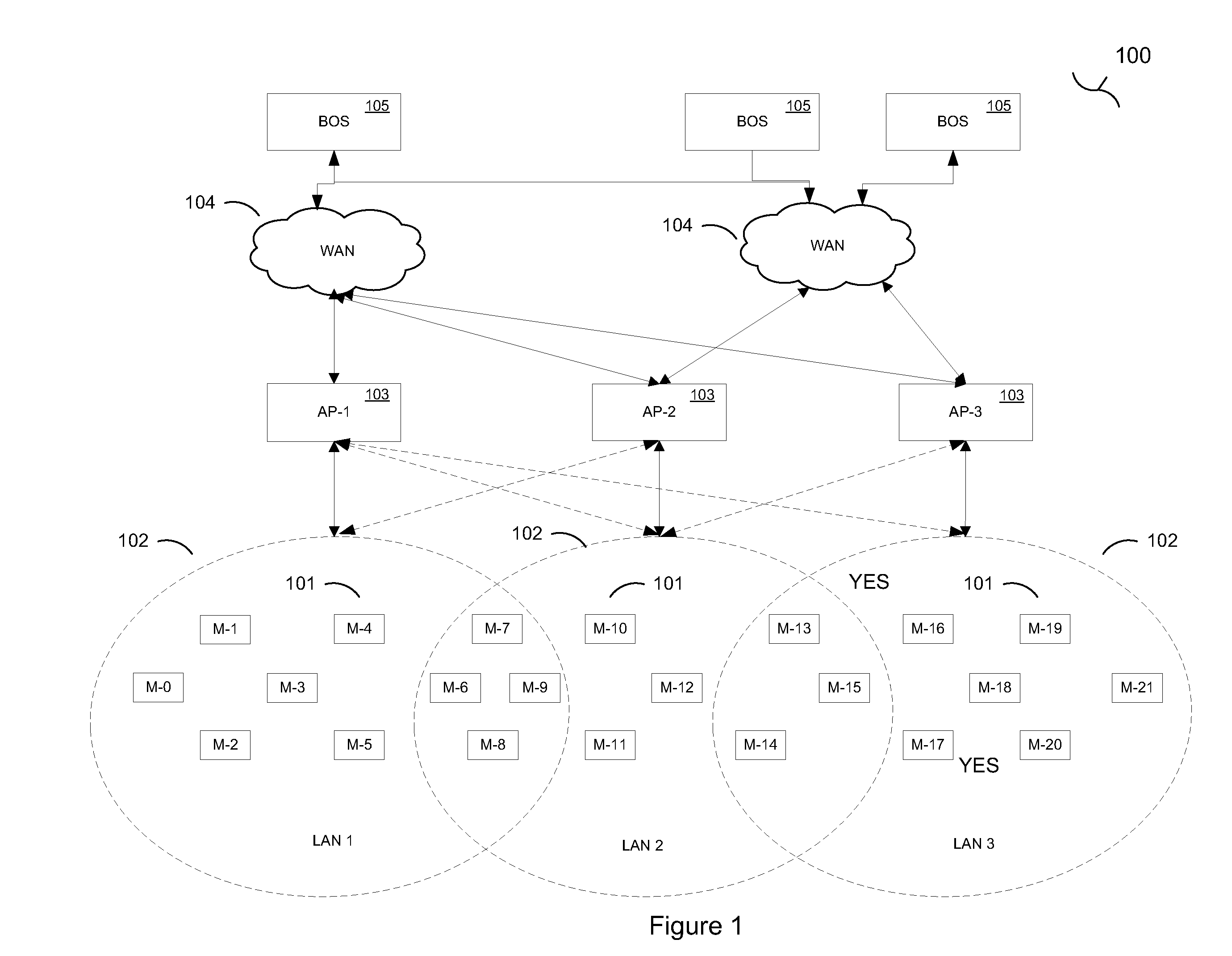

Comfort-driven optimization of electric grid utilization

InactiveUS20150094968A1Improve comfortUtilize and optimizeElectric devicesFinanceCommunication interfaceElectricity

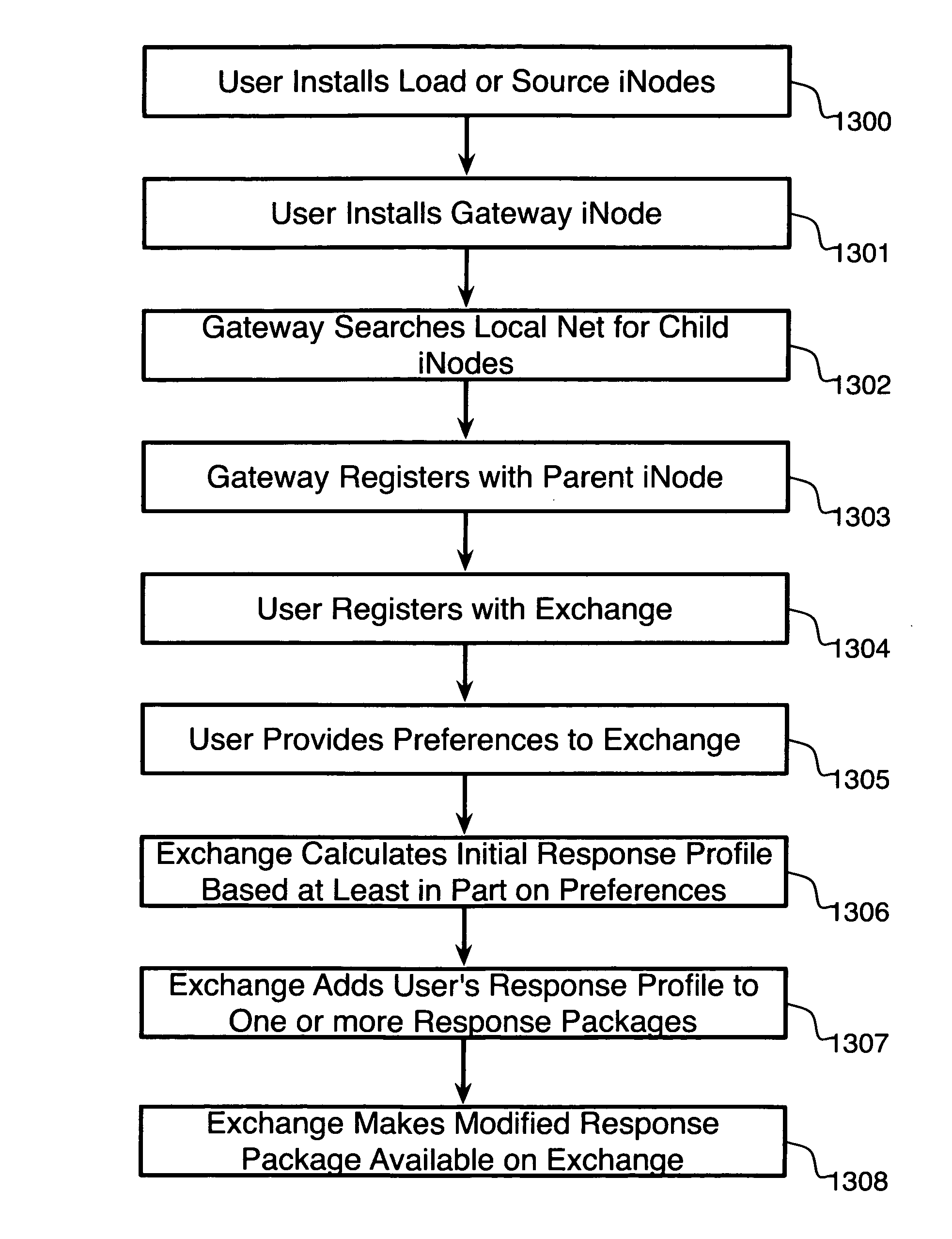

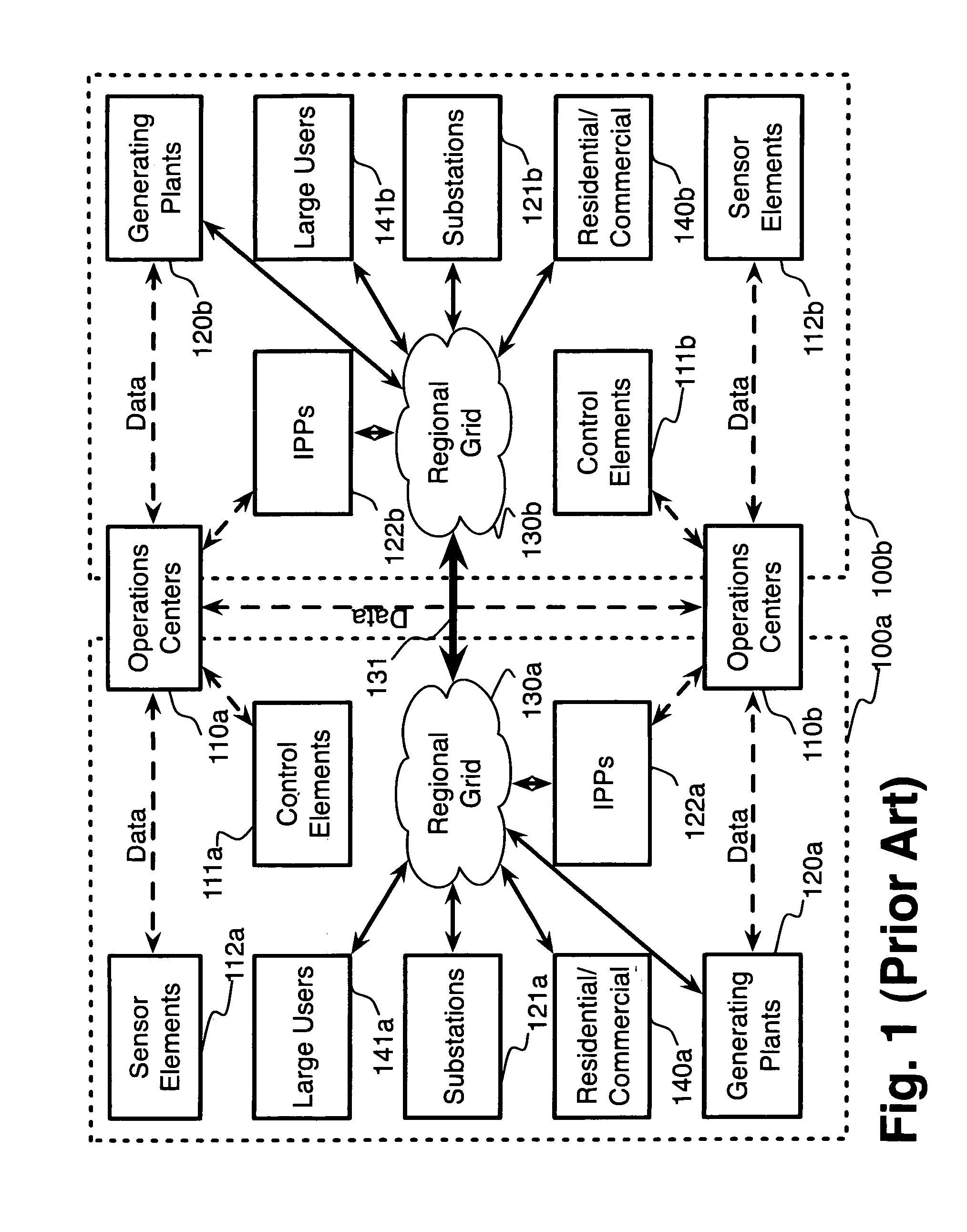

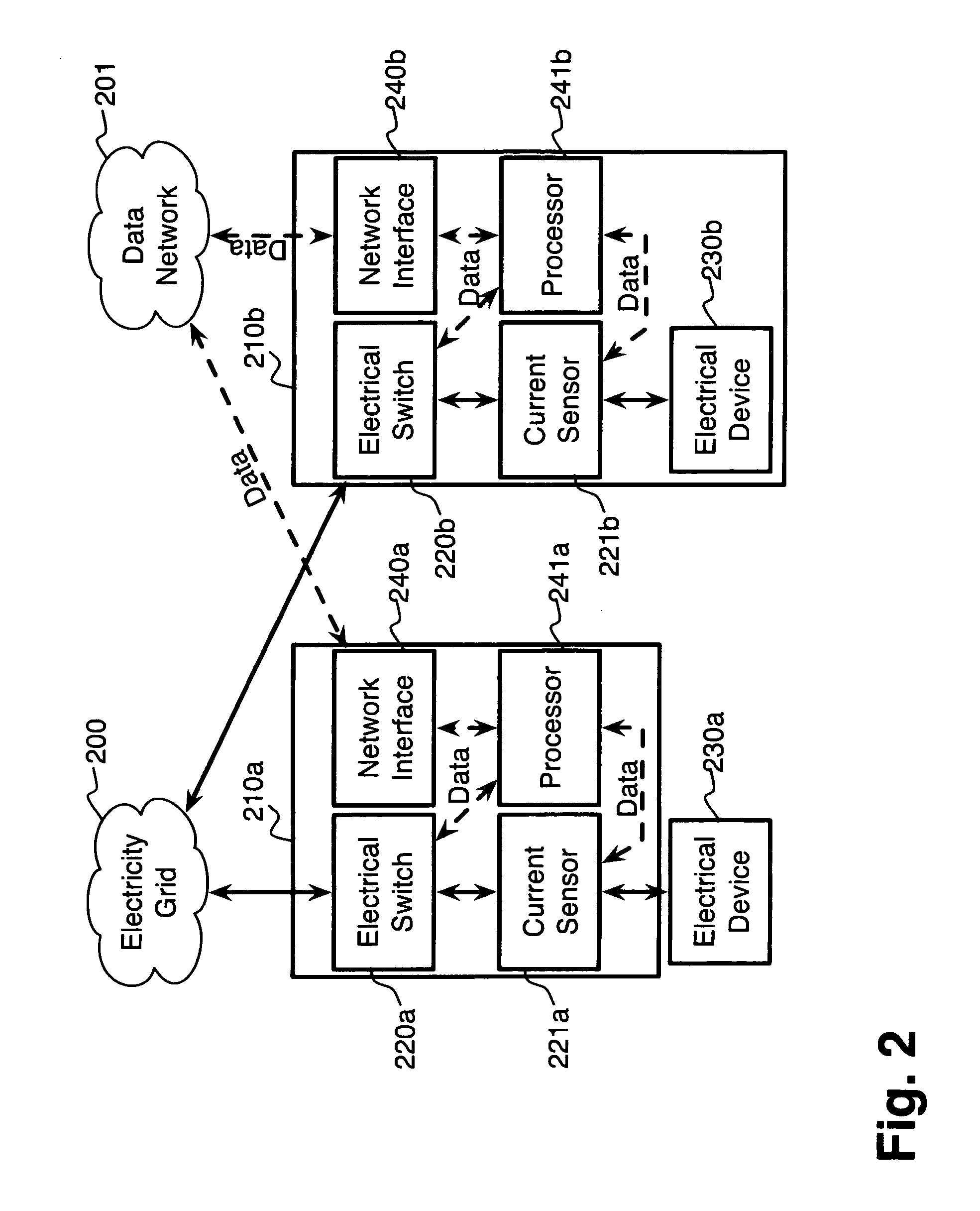

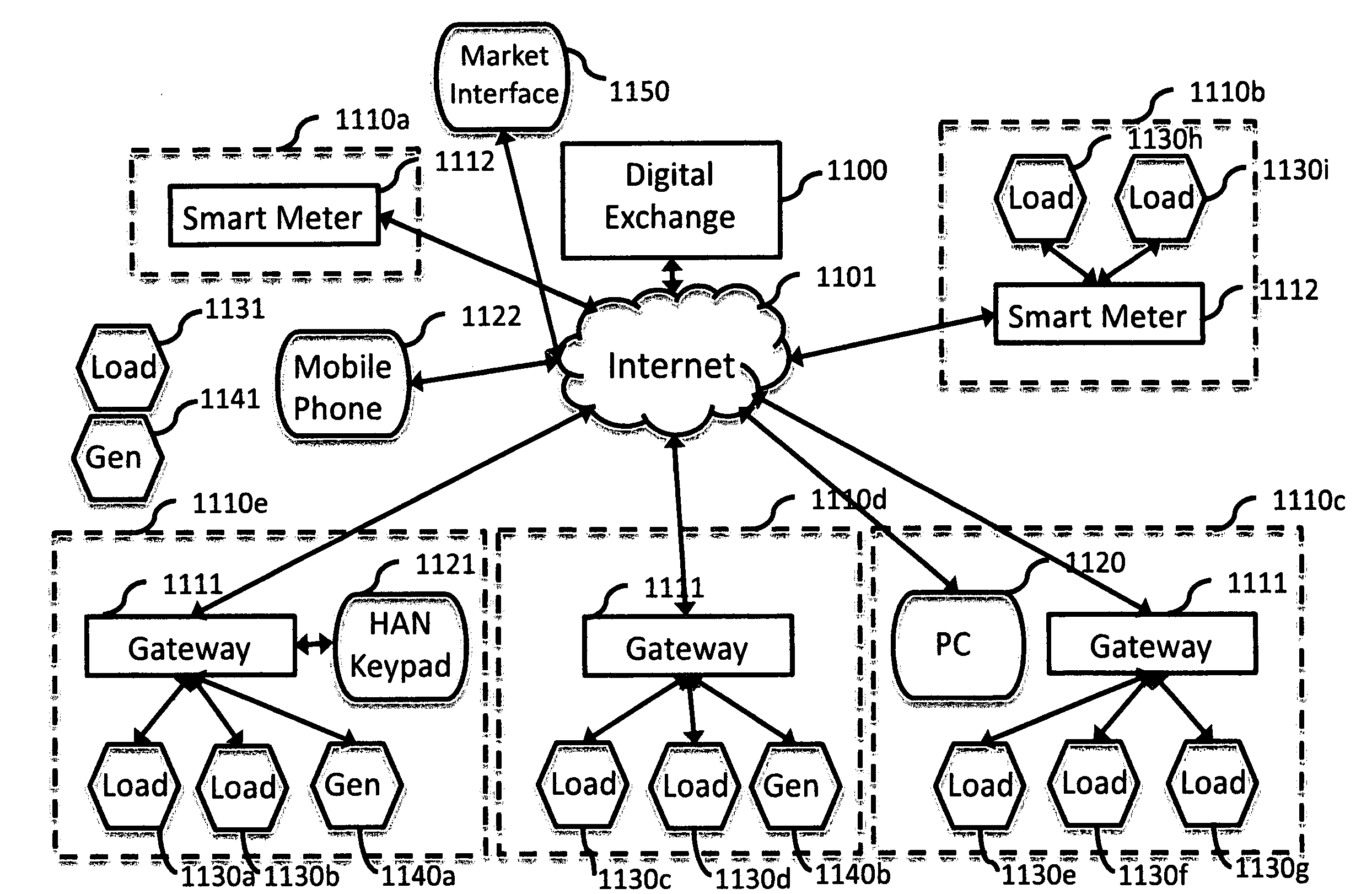

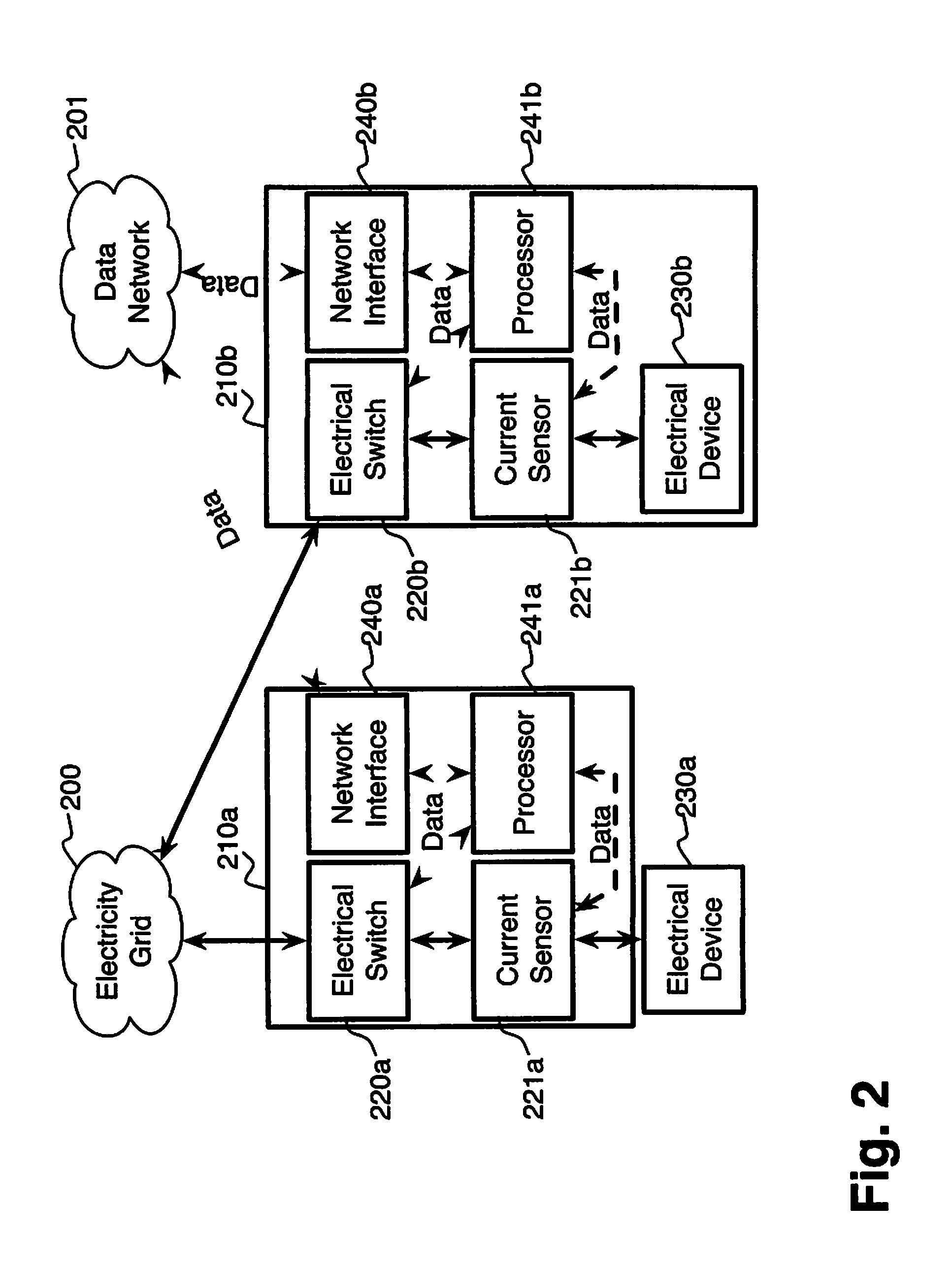

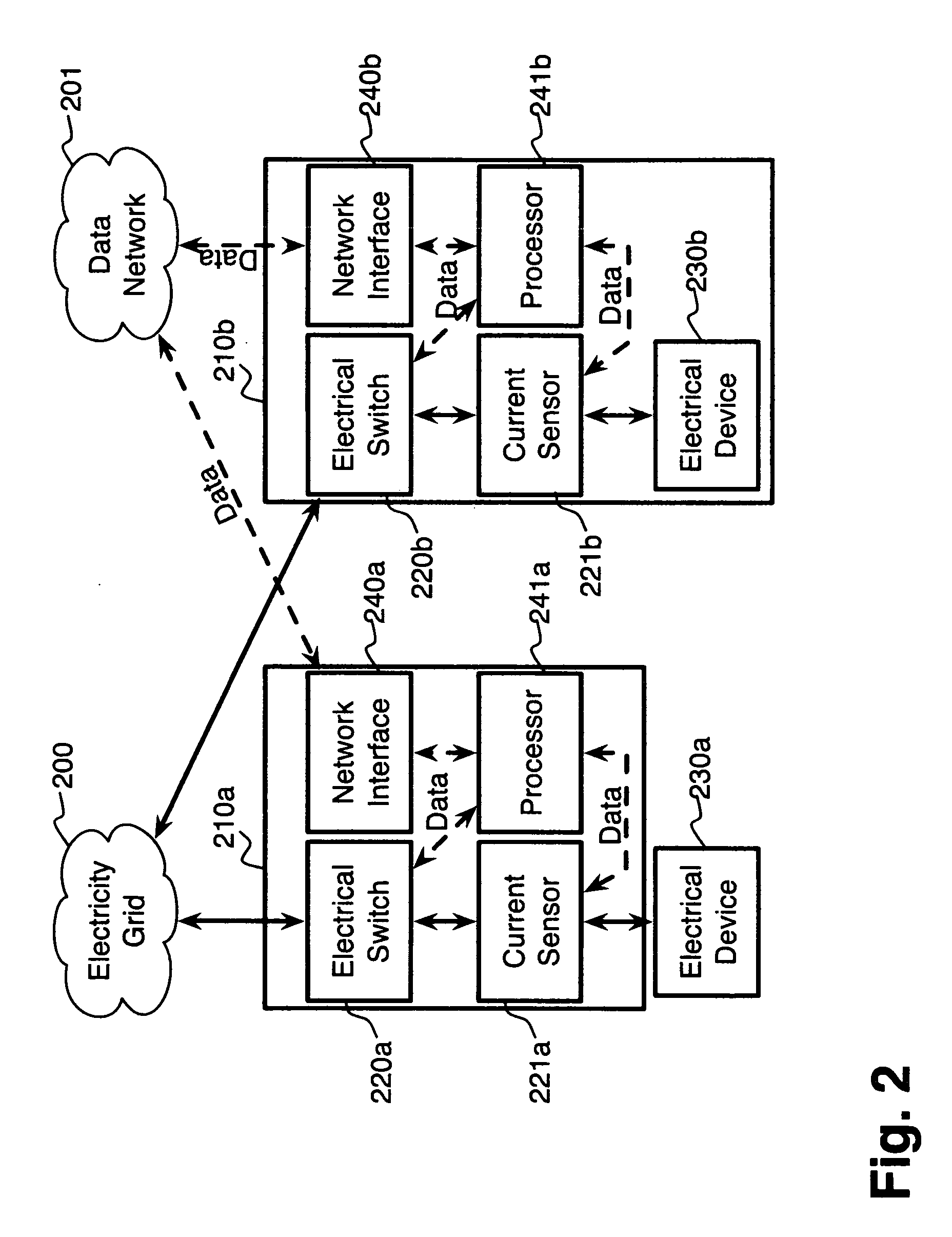

A system for electric grid utilization and optimization comprising a communications interface executing on a network-connected server and adapted to receive information from a plurality of iNodes, the plurality of iNodes comprising a source iNode, a sink iNode, a plurality of transmission or distribution iNodes, an event database coupled to the communications interface and adapted to receive events from a plurality of iNodes via the communications interface, a modeling server coupled to the communications interface, and a statistics server coupled to the event database and the modeling server, wherein the modeling server, receives a request to establish an allocation of at least one of transmission losses, distribution losses, and ancillary services to a specific sink iNode, computes at least one virtual path for electricity flow between a source iNode and the specific sink iNode, the computed path being determined based on optimization of perceived comfort of users in affected areas.

Owner:DISTRIBUTED ENERGY MANAGEMENT

Dynamic pricing system and method for complex energy securities

A dynamic pricing system for complex energy securities, comprising a communications interface executing on a network-connected server and adapted to receive information from a plurality of iNodes, an event database coupled to the communications interface and adapted to receive events from a plurality of iNodes via the communications interface, a pricing server coupled to the communications interface, and a statistics server coupled to the event database and the pricing server, is disclosed. According to the invention, the pricing server, on receiving a request to establish a price for an energy security, requests at least one statistical indicia of risk from the statistics server, the statistical indicia of risk being computed by the statistics server based on a plurality of historical data obtained from the event database, and the pricing server computes a price for the security based at least in part on the statistical indicia of risk.

Owner:CRABTREE JASON +3

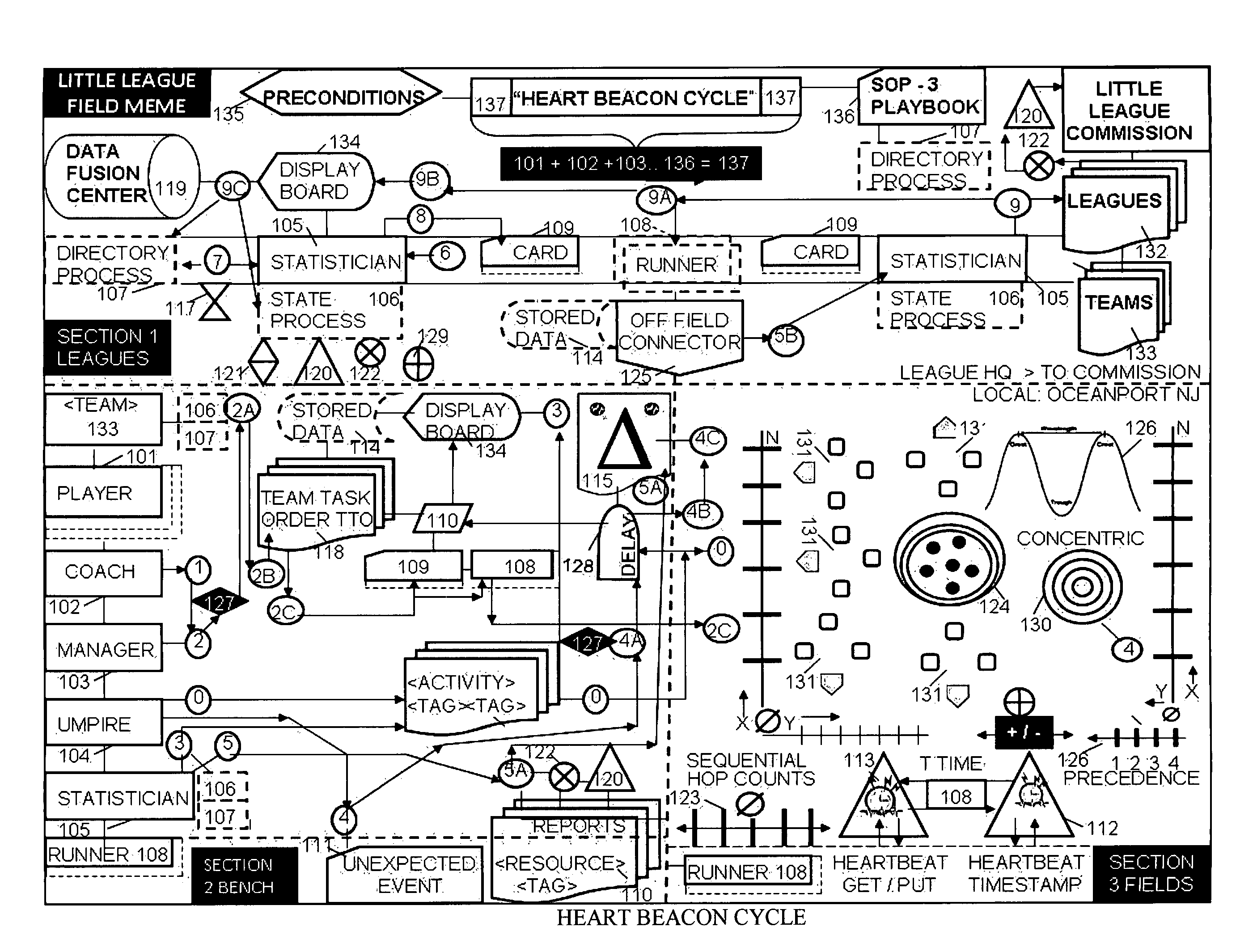

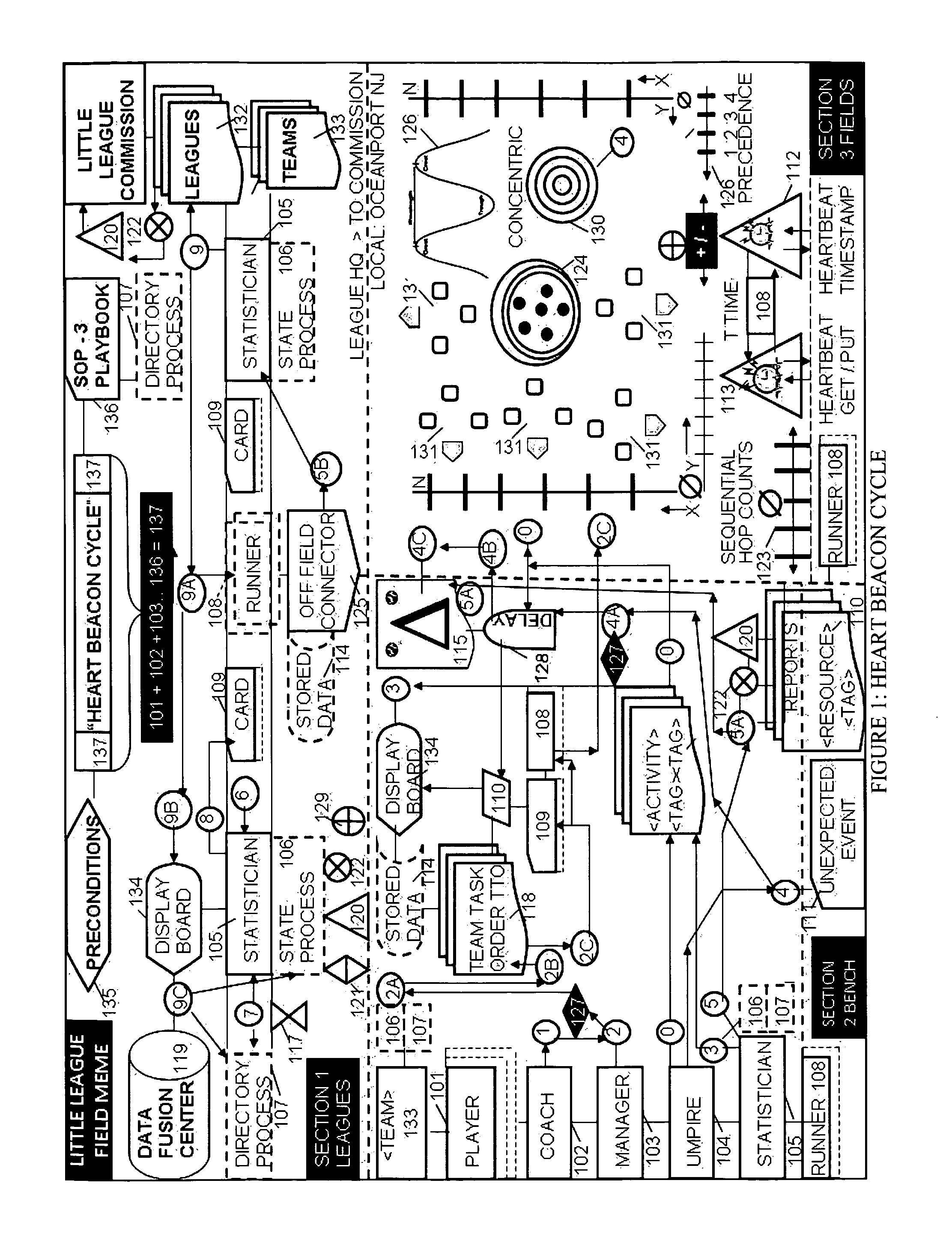

Heart beacon cycle

InactiveUS20140310243A1FinanceDigital data processing detailsTheoretical computer scienceGood practice

Systemic, adaptive procedural template comprised of common building blocks forming template frameworks i.e., self-organizing, mutually reinforcing service, system, process, procedure components derived situational understanding, state meta data signaling replication systems consisting of TCP / IP heartbeat, heartbeat messages signaling during micro-macro report cycles of state meta-data sync deltas <class> typed with <ORG_ID>, <URN> time stamped prior to data fusion-center insertion followed by reports aggregated, recalculated, relayed through synchronization, conversion gateways then merged into macro-cycle reports where metrics, metering are described by using Paul Revere meme linear, sequential hop count, water-drop in-pond meme geo-spatial temporal intensity measures, metrics recording sync deltas change across time / space viewed on appliqué displays using Russian Matryoshka doll techniques where each view adds to, changes the nature, meaning of composite views while retaining original appliqué views unique qualities as decision support aids in best effort, best practice by federated groups

Owner:MCGEE MR STEVEN JAMES

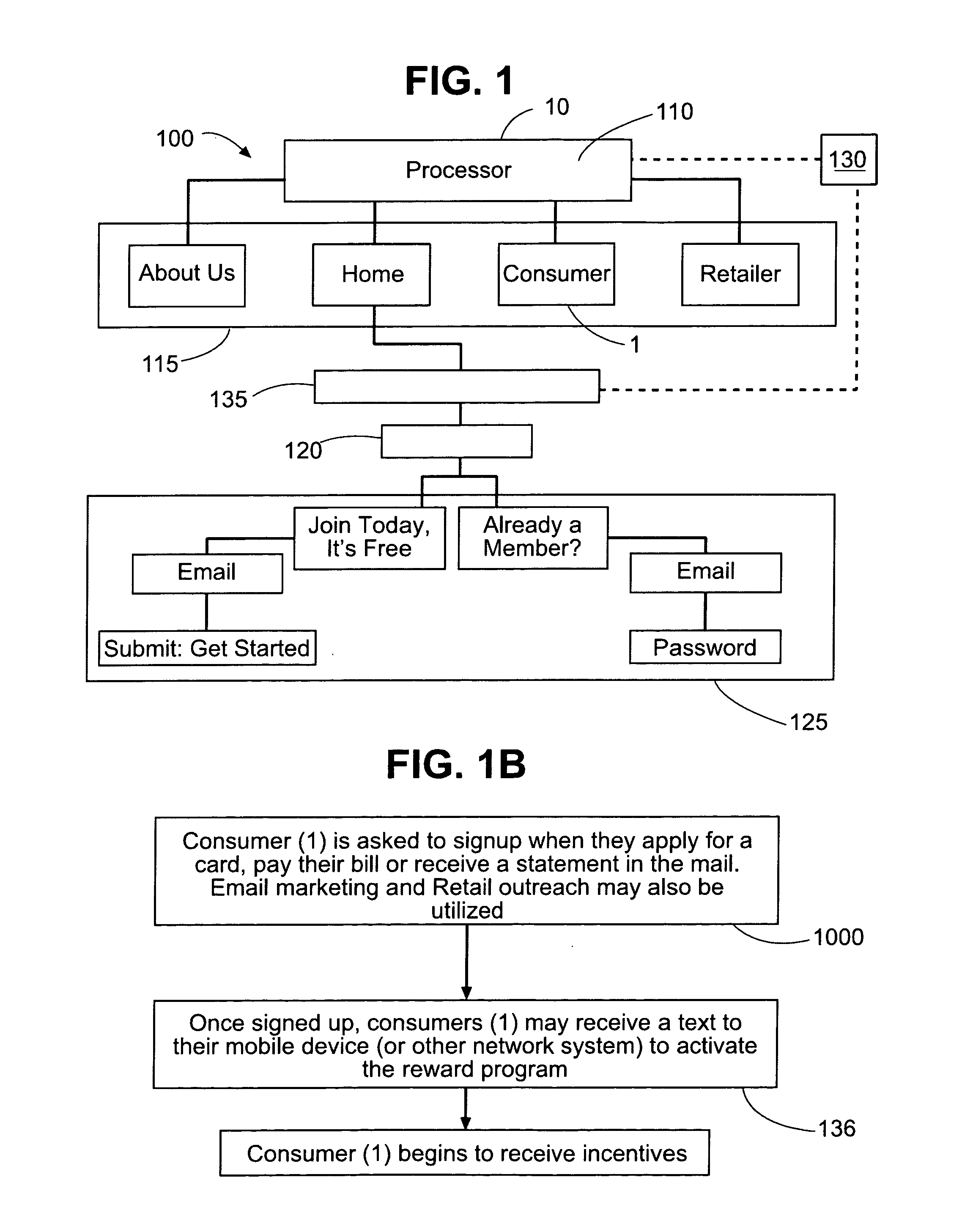

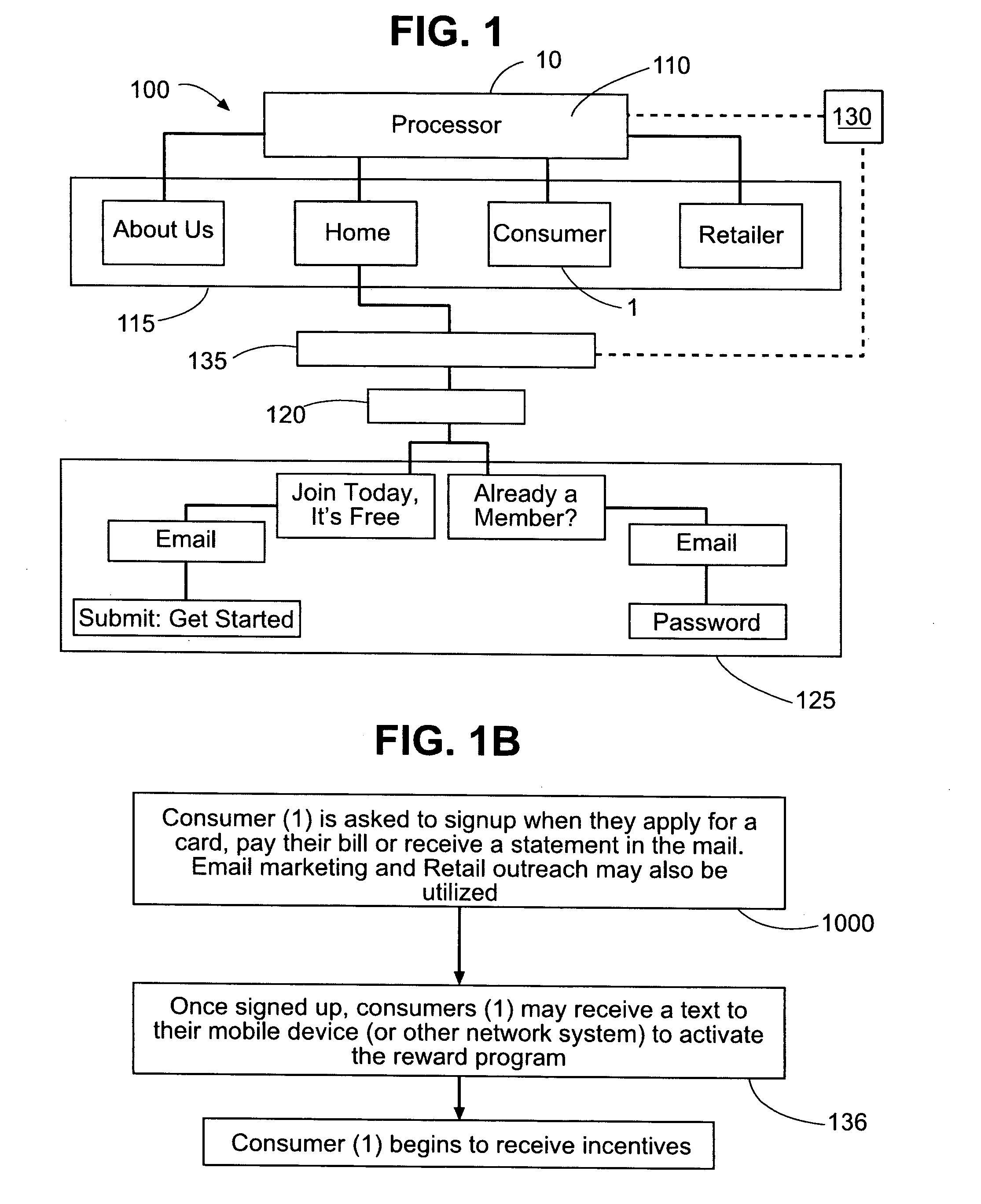

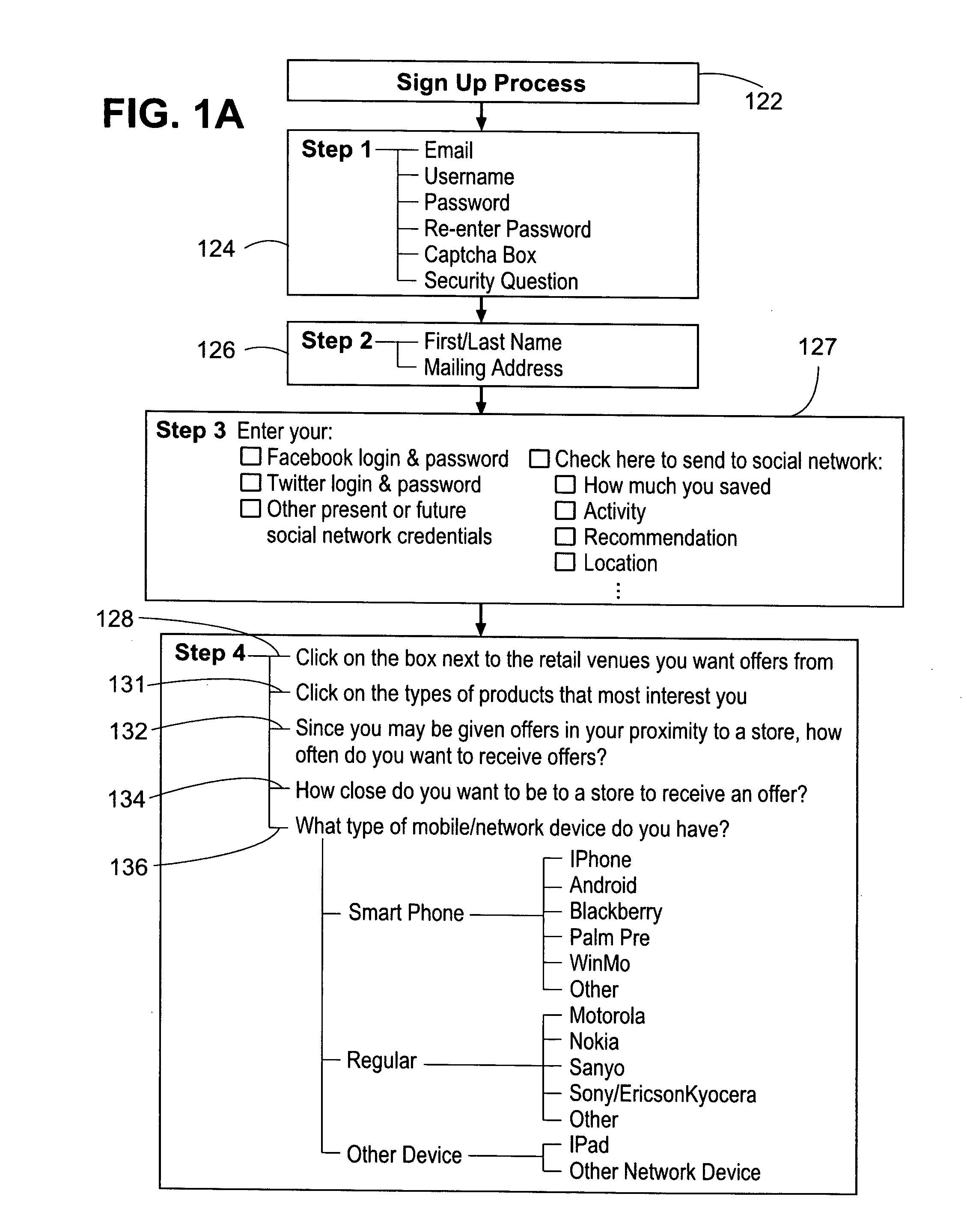

Electronic coupon creation deployment, transference, validation management, clearance, redemption and reporting system and interactive participation of individuals and groups within the system

ActiveUS20110029363A1Directly appliedHigh reliabilityTechnology managementFinancial managementE-commerceReporting system

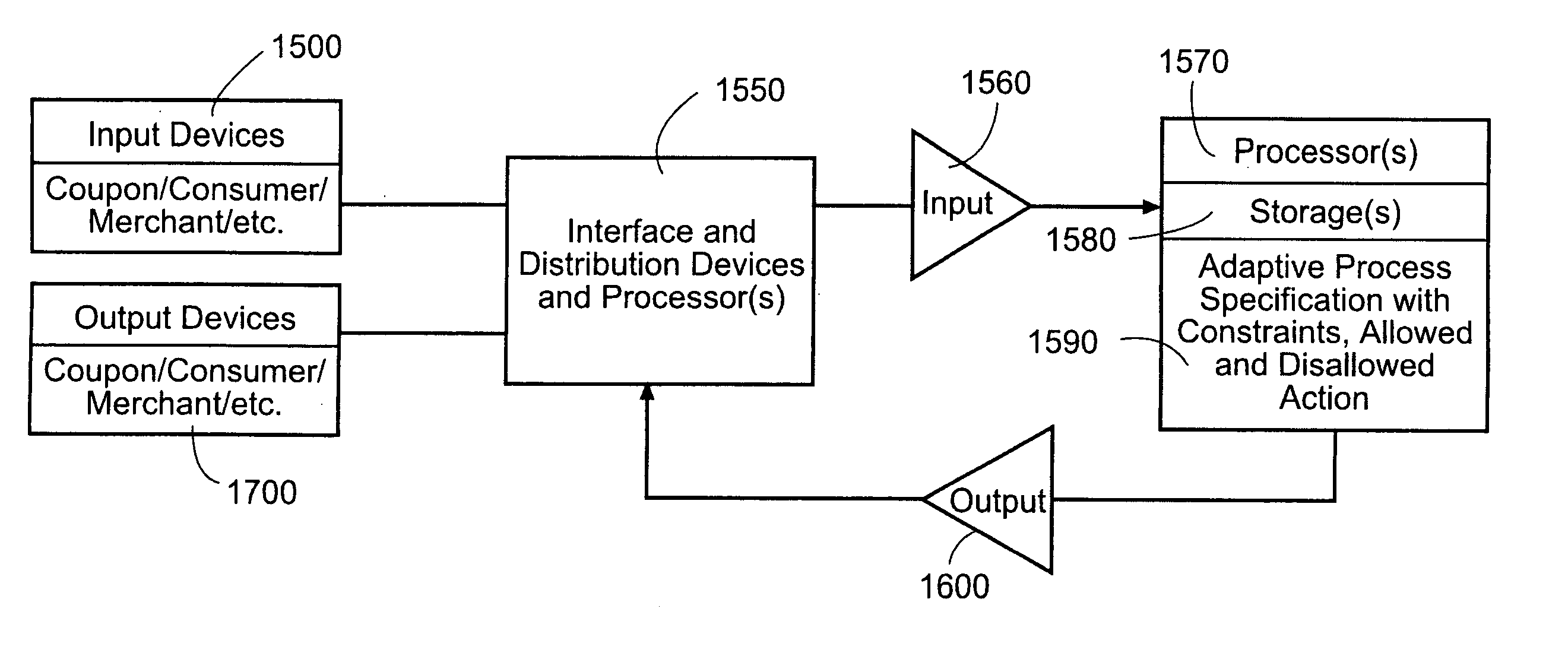

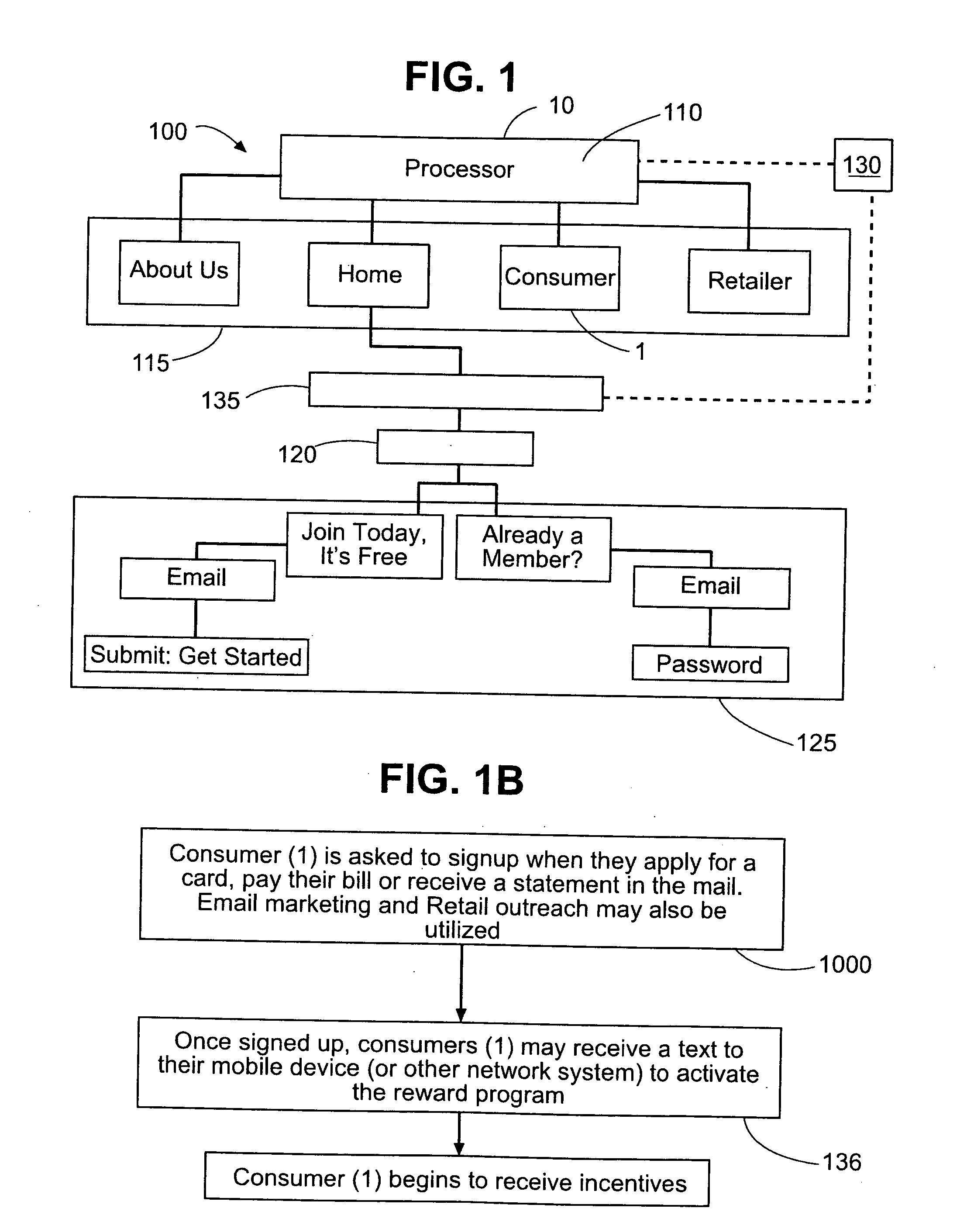

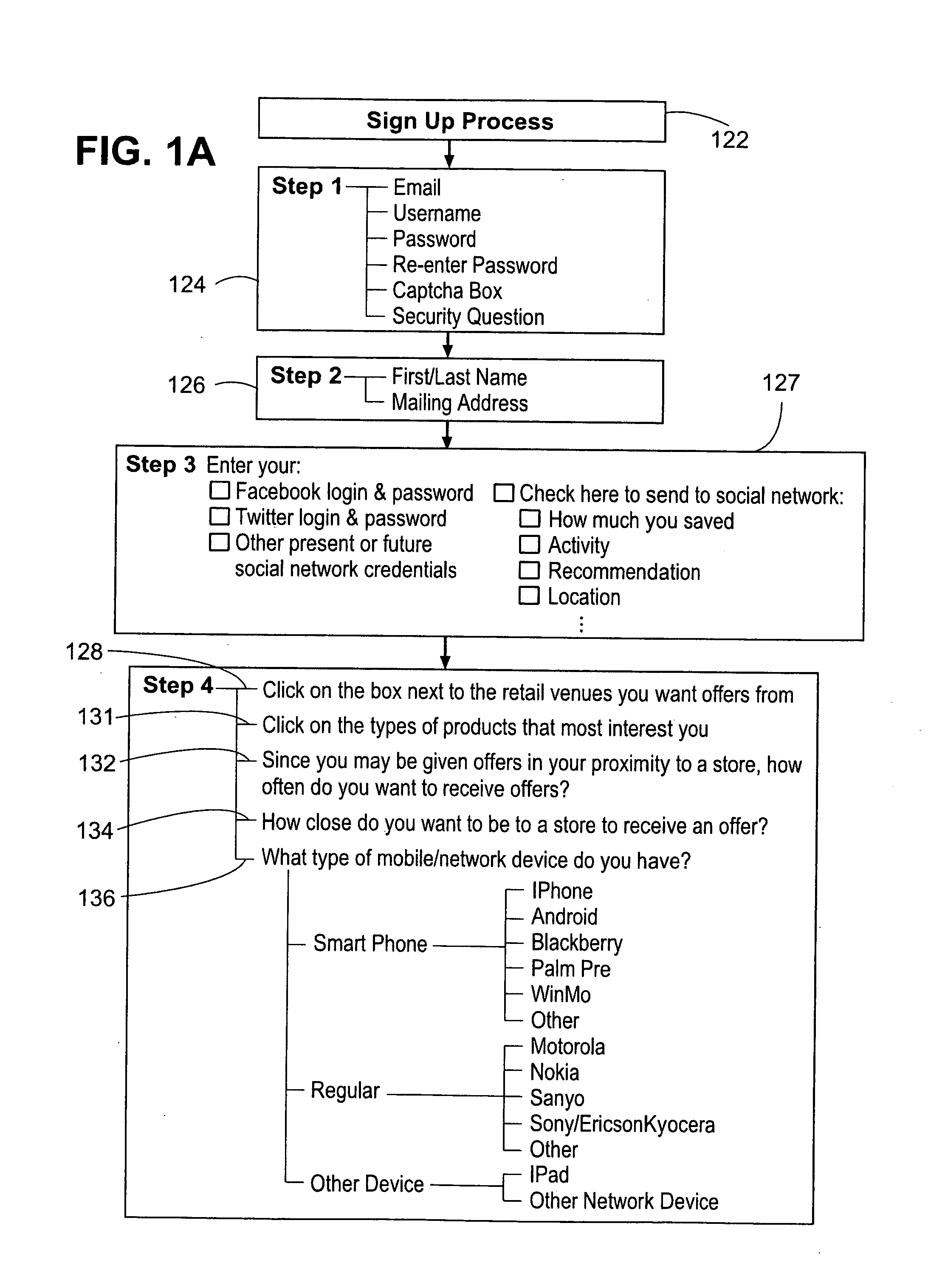

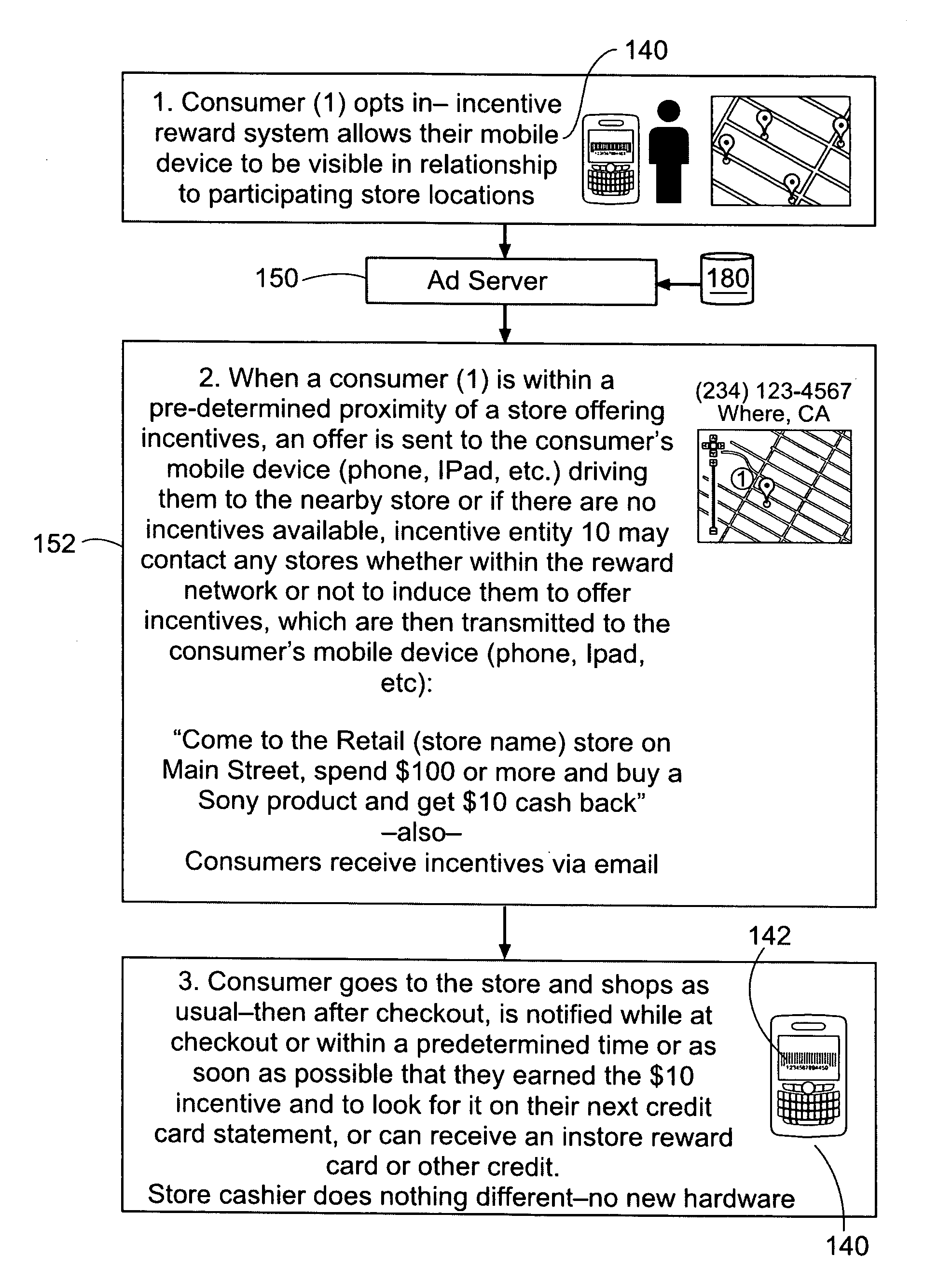

This invention relates generally to electronic commerce (e-commerce) systems and media platforms, for use with both mobile and non-mobile systems, to deploy virtual advertising and promotion via the use of electronic coupons, and more particularly a method and system for creating, deploying, transferring, clearing, managing, redeeming and reporting on the use of electronic coupons or virtual electronic rebates (VeeBates) and permitting individuals and groups within one or more social communications networks to participate in and transmit information to others about their activities related to the virtual advertising, incentives, redemption and promotion.

Owner:MASTERCARD INT INC

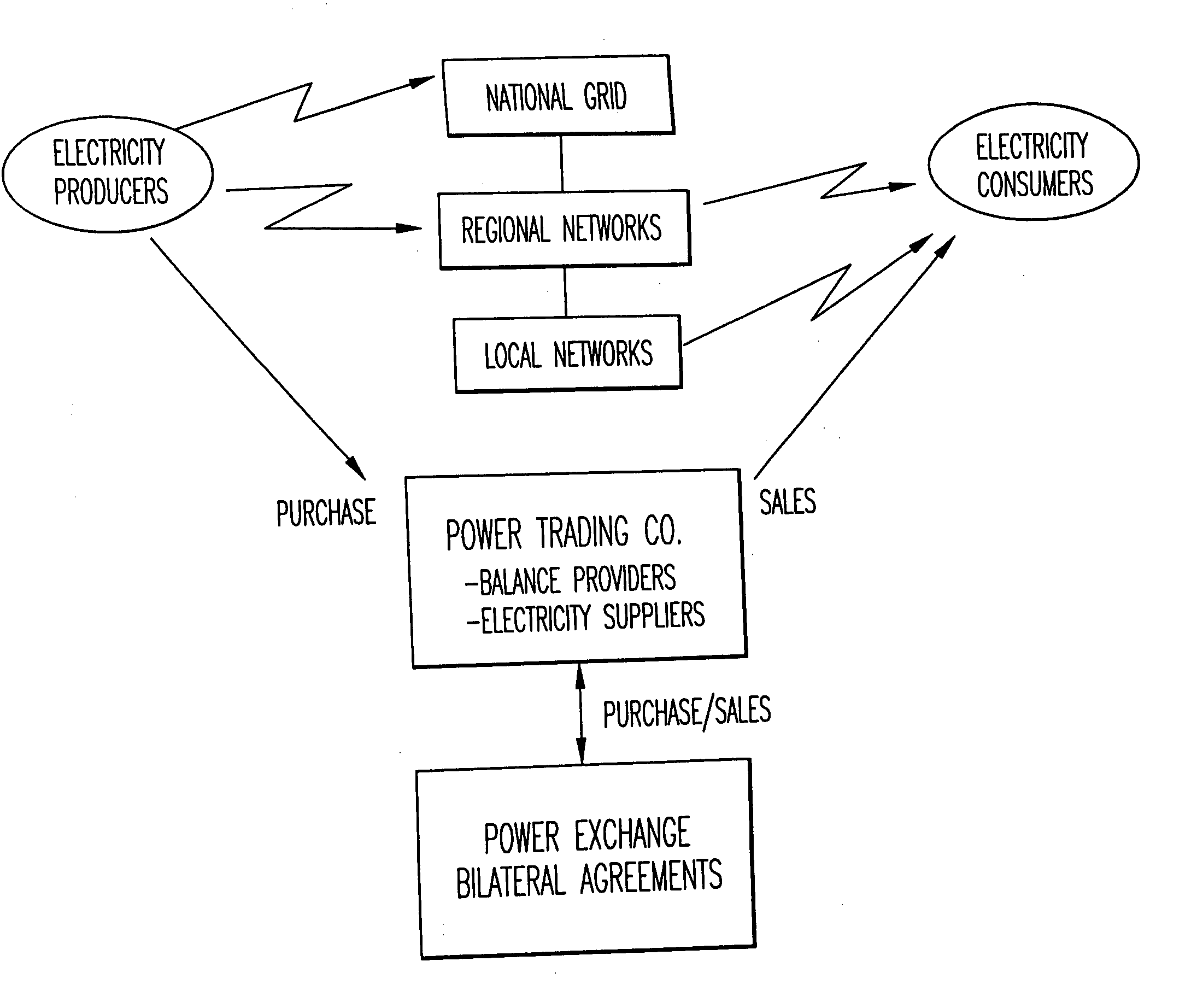

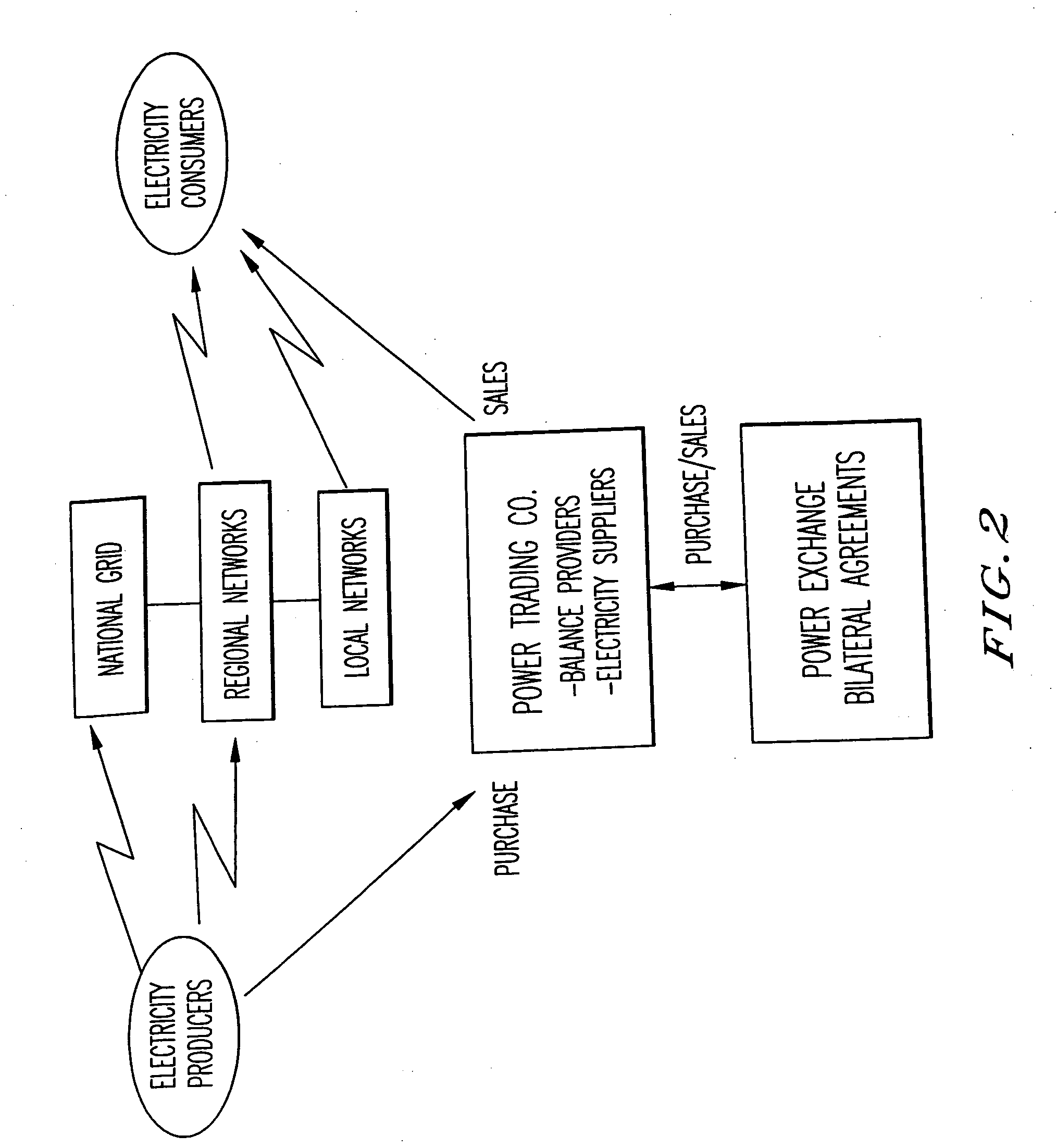

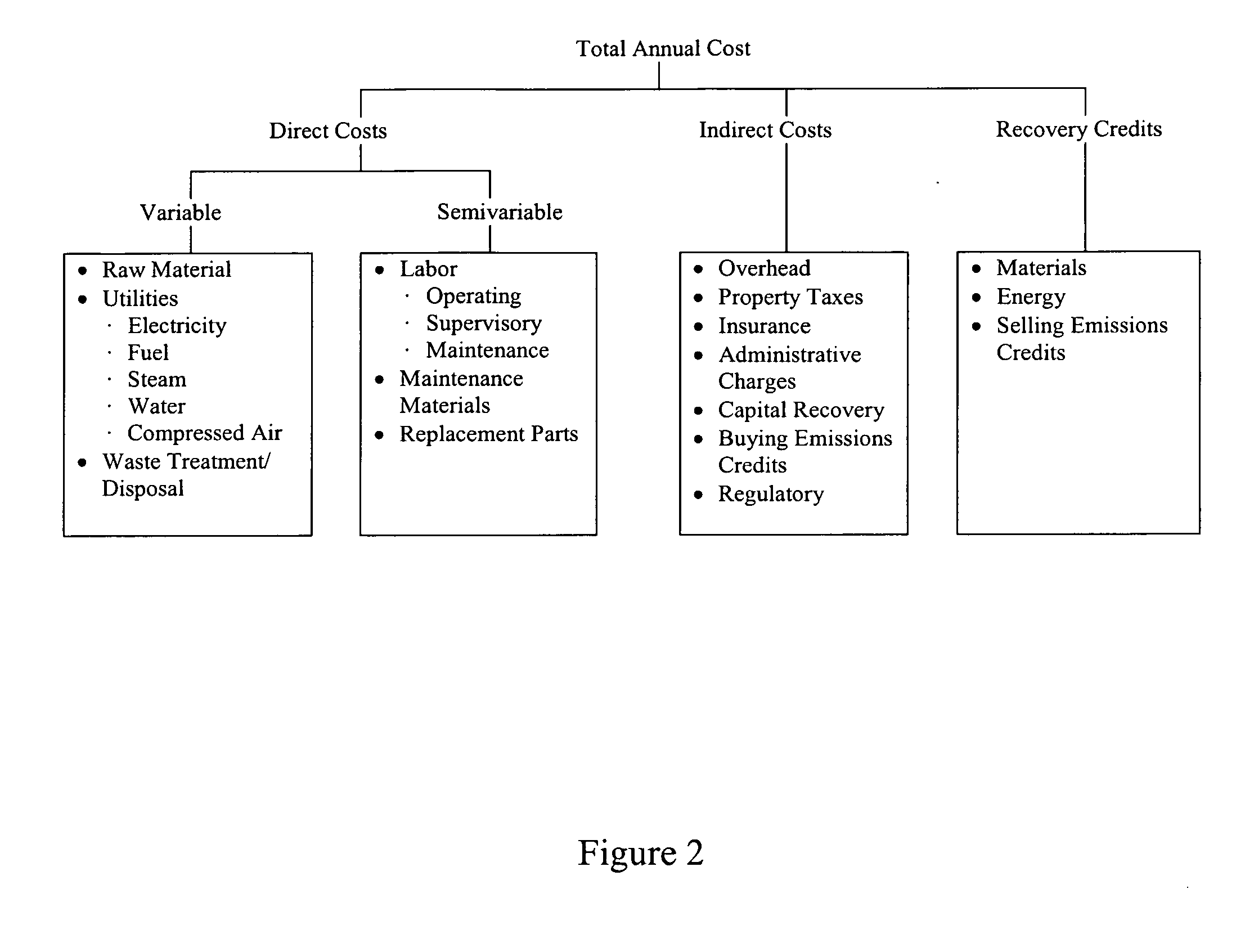

System, method and computer program product for enhancing commercial value of electrical power produced from a renewable energy power production facility

InactiveUS20050127680A1Increase power valueInherent market valueWind motor controlEngine fuctionsPower exchangeRenewable power generation

A method, system and computer program product enhance the commercial value of electrical power produced from a wind turbine production facility. Features include the use of a premier power conversion device that provides an alternative source of power for supplementing an output power of the wind turbine generation facility when lull periods for wind speed appear. The invention includes a communications infrastructure and coordination mechanism for establishing a relationship with another power production facility such that when excess electrical power is produced by the wind turbine facility, the excess may be provided to the power grid while the other energy production facility cuts back on its output production by a corresponding amount. A tracking mechanism keeps track of the amount of potential energy that was not expended at the other facility and places this amount in a virtual energy storage account, for the benefit of the wind turbine facility. When, the wind turbine power production facility experiences a shortfall in its power production output it may make a request to the other source of electric power, and request that an increase its power output on behalf of the wind turbine facility. This substitution of one power production facility for another is referred to herein as a virtual energy storage mechanism. Furthermore, another feature of the present invention is the use of a renewal power exchange mechanism that creates a market for trading renewable units of power, which have been converted into “premier power” and / or “guaranteed” by secondary sources of power source to provide a reliable source of power to the power grid as required by contract.

Owner:ABB (SCHWEIZ) AG

REC credit distribution system and method

InactiveUS20080086411A1Easy to recycleImprove participationSustainable waste treatmentAcutation objectsReward systemDistribution system

A method for promoting recycling from a fund established with revenue generated from the sale of environmental and / or power generation attributes by an entity producing renewable energy. The method comprises providing a point system by which a recycling consumer is credited for recycled materials collected. Further, the method provides for a reward system for redemption of points accumulated by the recycling consumer, the reward system including redeemable fund certificates drawn against the fund. The method further includes collecting recyclable materials from the recycling consumer and crediting an account in the name of the recycling consumer based on the quantity and / or quality of the recyclable material collected. Then the method provides for awarding fund certificates to the recycling consumer upon the accumulation of a sufficient point level.

Owner:CASELLA WASTE SYSTEMS

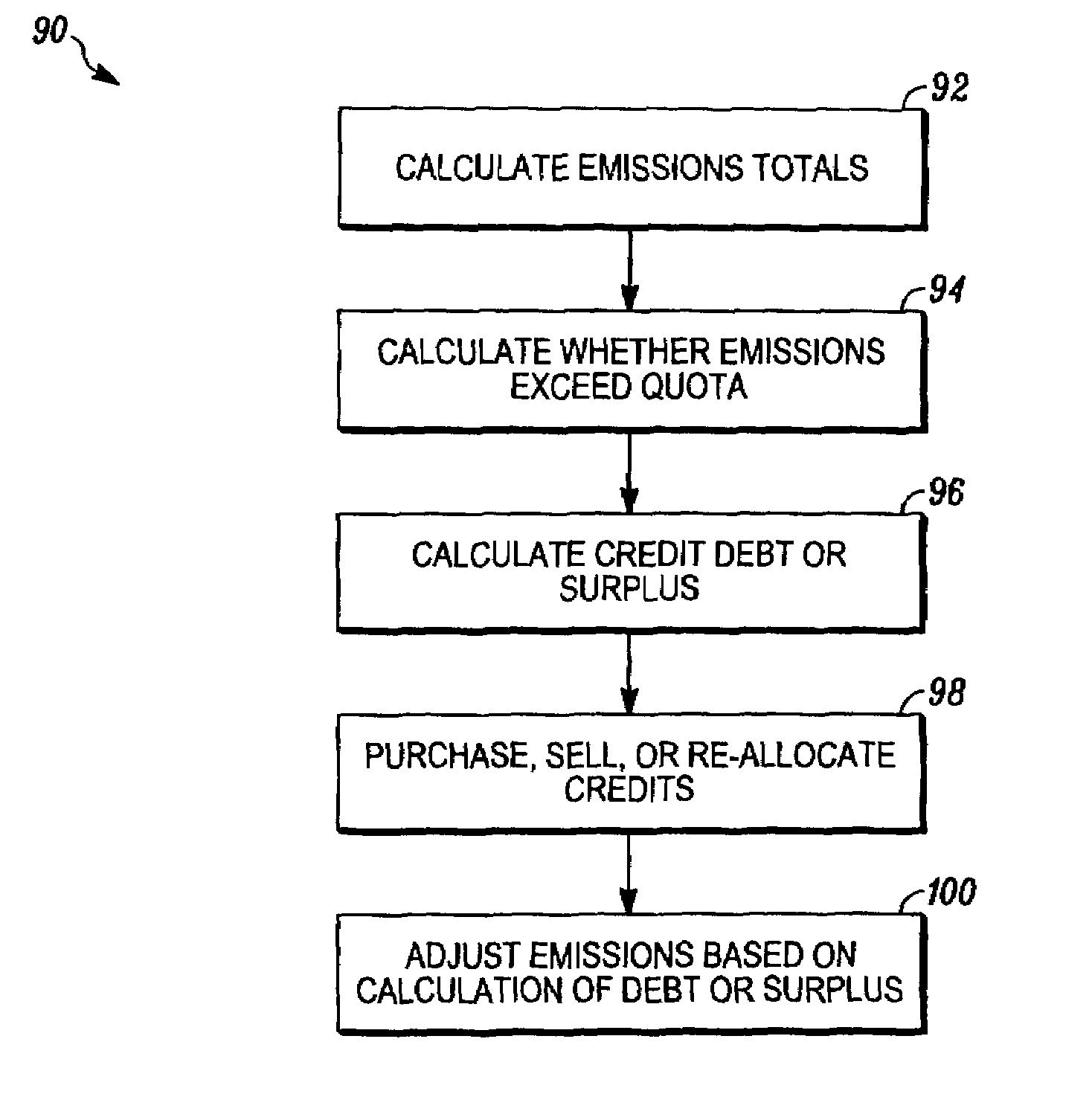

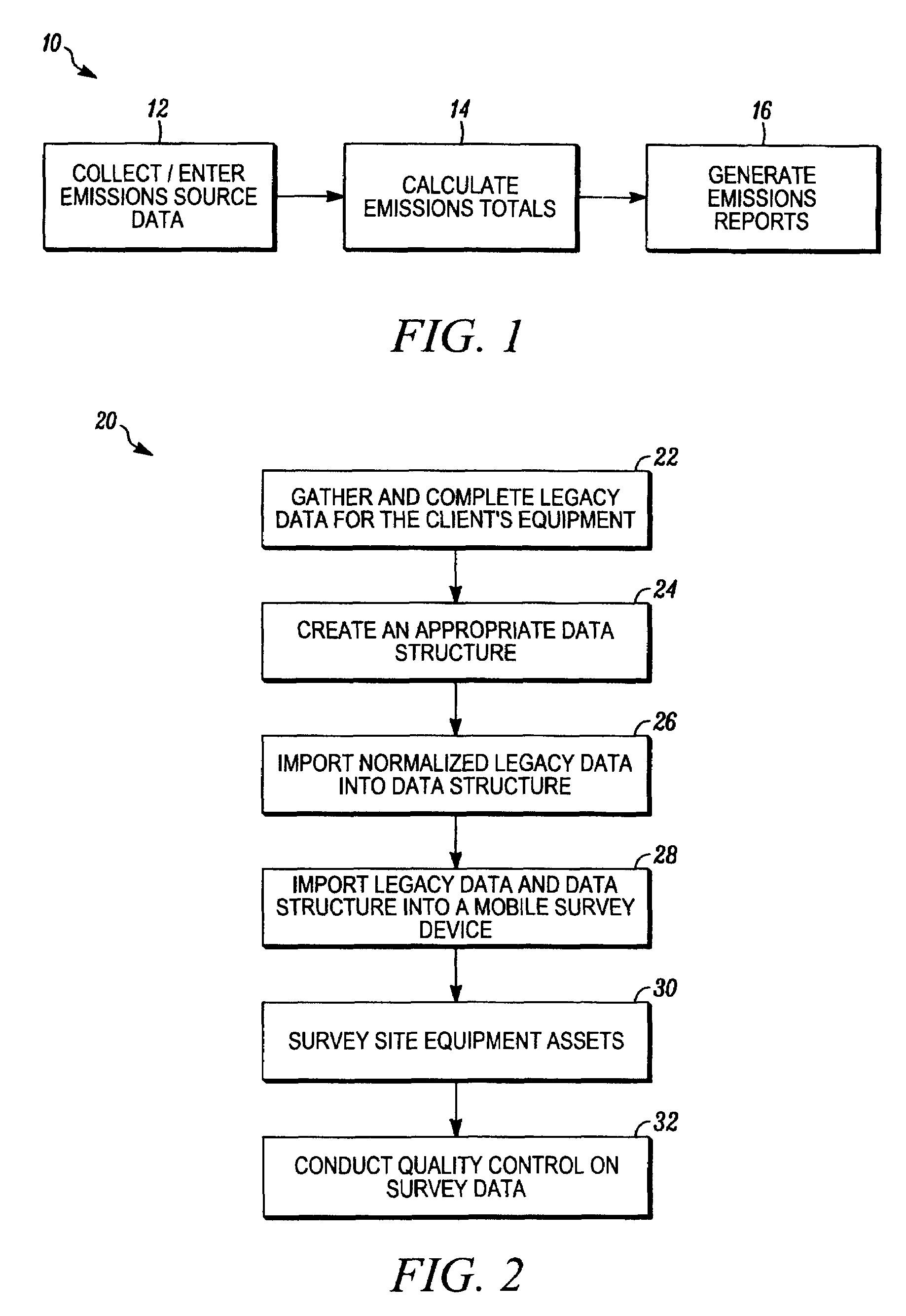

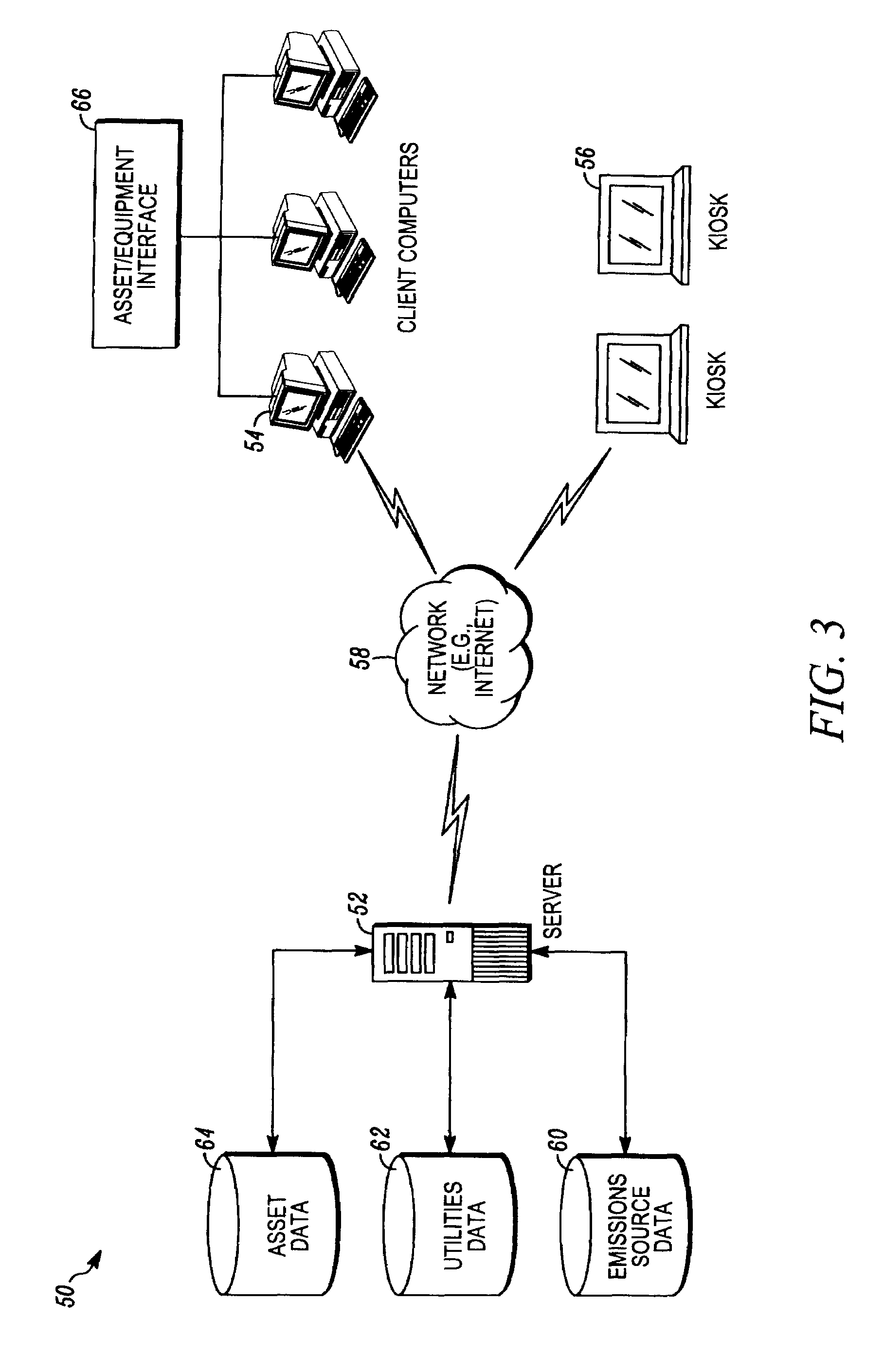

Method and system for tracking and reporting emissions

The present invention relates to methods and systems of tracking enterprise gas emissions such as greenhouse gas emissions. The systems and methods relate to collecting or entering data relating to one or more emissions source of an enterprise or an enterprise location, calculating emissions totals, and, according to certain embodiments, generating emissions reports.

Owner:VERISAE

Electronic incentivie methods and systems for enabling carbon credit rewards and interactive participation of individuals and groups within the system

ActiveUS20100250356A1Improve permeabilityHigh of common common consuming desireFinanceTechnology managementCarbon footprintCarbon credit

This invention relates generally to electronic commerce (e-commerce) systems and media platforms, for use with both mobile and non-mobile systems, to deploy virtual advertising and promotion via the use of electronic coupons, and more particularly a method and system for aggregating and distributing carbon reduction credits in connection with the creation and / or use of electronic coupons or virtual electronic rebates (VeeBates) and permitting individuals and groups within one or more social communications networks to participate in and transmit information to others about their activities related to the virtual advertising, incentives, redemption and promotion and aggregate carbon credits in connection therewith, either as part of the incentive or aggregation by the incentive promoter as part of its activities in reducing its carbon footprint.

Owner:TRANSACTIS

Electronic coupon system and data mining and use thereof in relation thereto and for use interactive participation of individuals and groups within the system

ActiveUS20100250359A1Improve permeabilityHigh of common common consuming desireTechnology managementColor television detailsE-commerceMobility system

This invention relates generally to electronic commerce (e-commerce) systems and media platforms, for use with both mobile and non-mobile systems, to deploy virtual advertising and promotion via the use of electronic coupons, and more particularly a method and system for creating, deploying, transferring, clearing, managing, redeeming and reporting on the use of electronic coupons or virtual electronic rebates (VeeBates) and permitting individuals and groups within one or more social communications networks to participate in and transmit information to others about their activities related to the virtual advertising, incentives, redemption and promotion.

Owner:TRANSACTIS

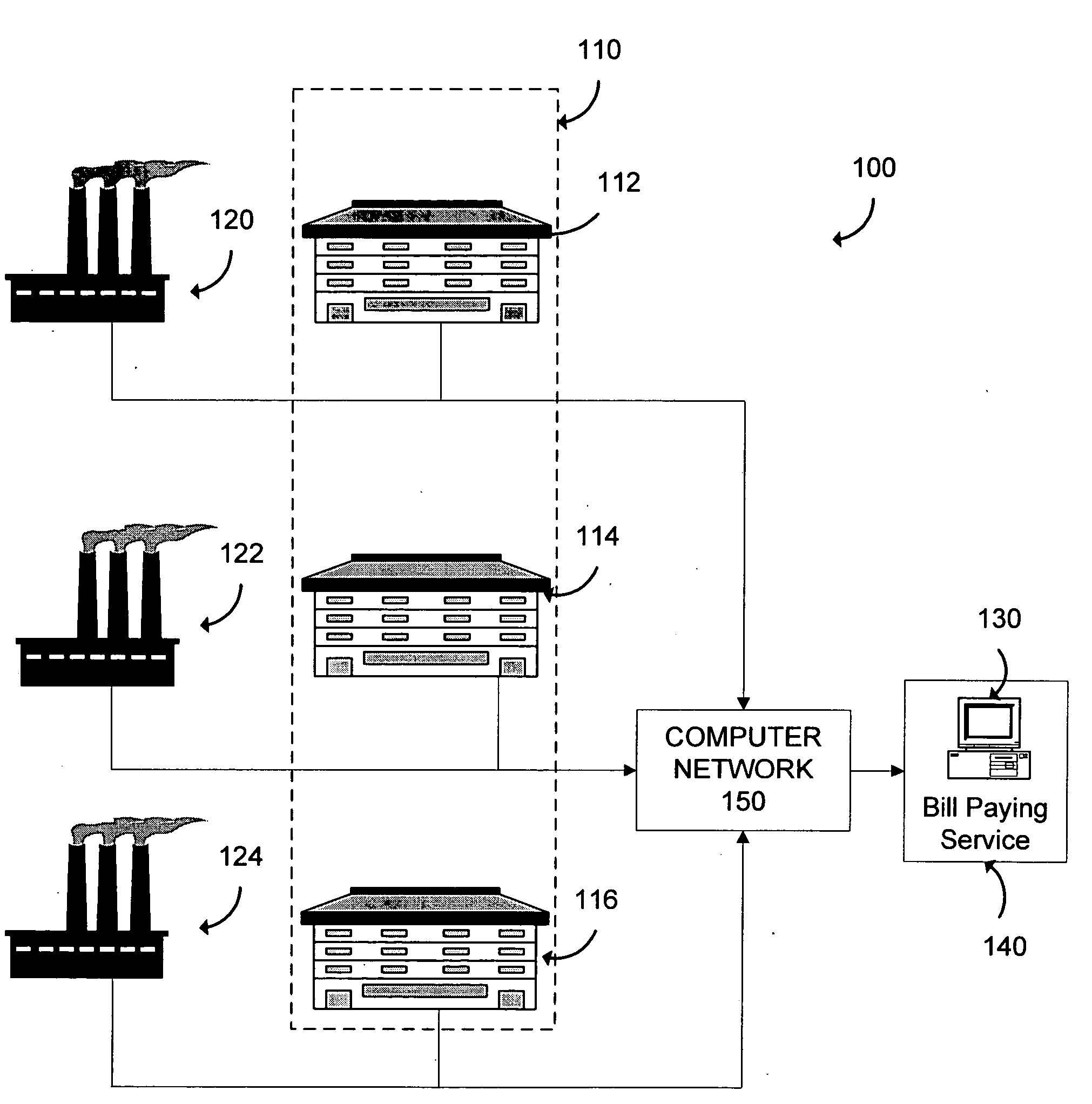

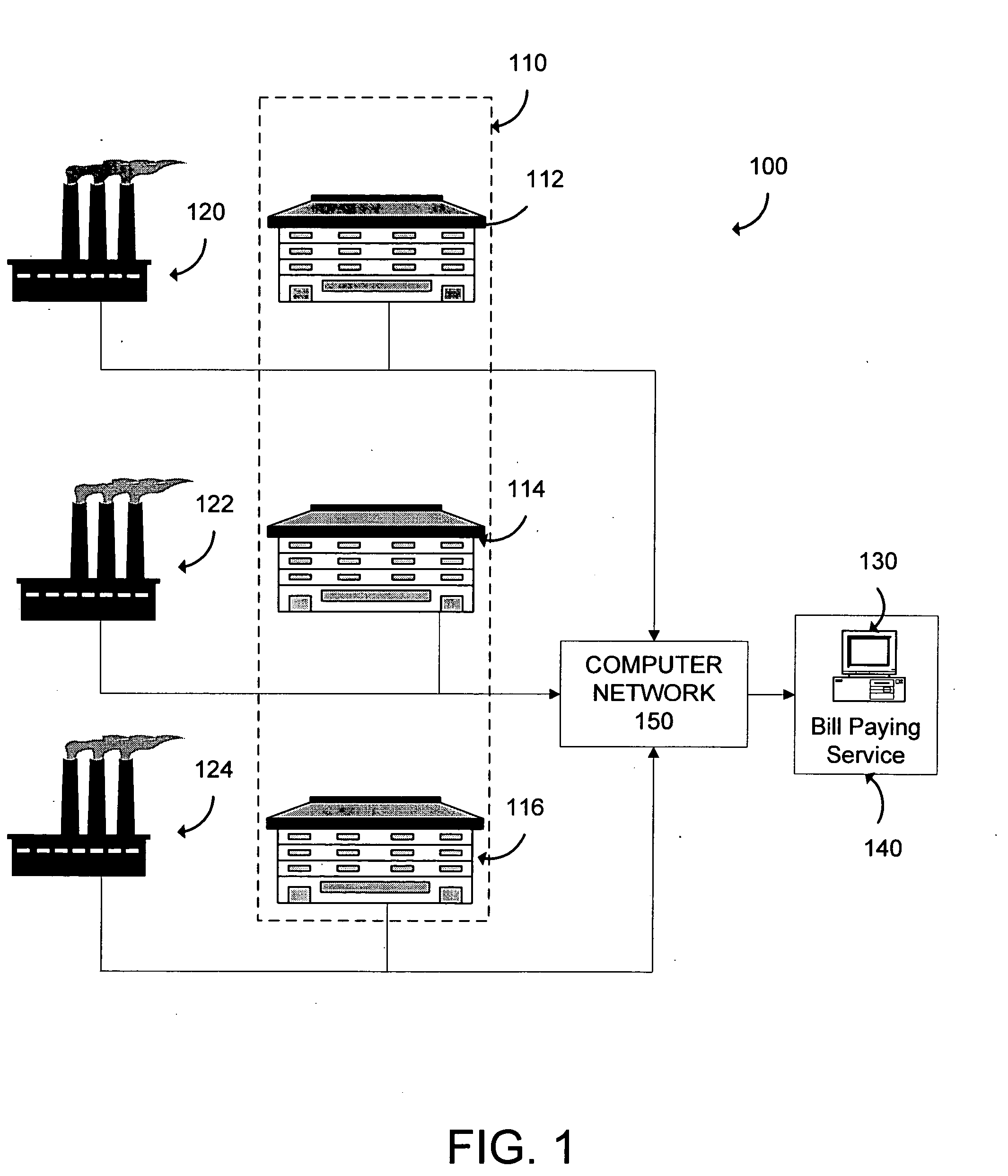

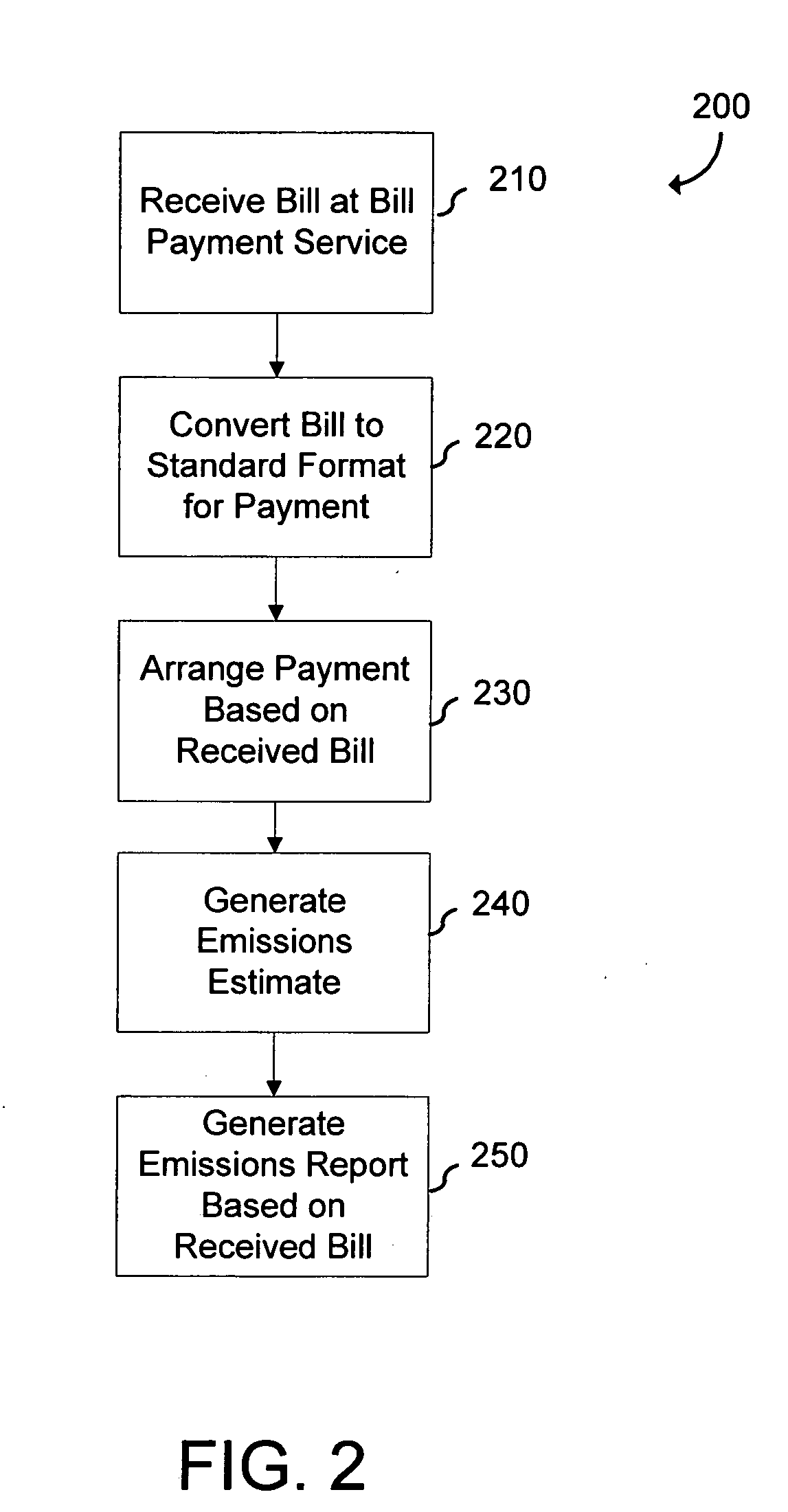

System and method for tracking emissions

A system for estimating emissions based on bills paid through a bill paying service. The system includes a bill payment processor configured to receive a bill for an external entity and arrange for a payment based on the bill, an emission estimation engine configured to generate an emissions estimate based on the bill, and a reporting engine configured to provide the emission estimate.

Owner:JOHNSON CONTROLS TECH CO

Method and System of Applying Environmental Incentives

InactiveUS20100228601A1Update displayLevel controlVolume/mass flow measurementAutomatic controlRelevant information

Information relating to electrical energy usage for a given account is associated with a time segment that corresponds to a period when the electrical energy was received from an electrical energy distribution system. Electrical energy generation carbon impact information is retrieved for the corresponding time segment specifying when the electrical energy was received from an electrical energy distribution system. A carbon credit is calculated according to the retrieved electrical energy generation carbon impact information, and the retrieved electrical energy usage information associated with the time segment. The calculated carbon credit is then used to update a display of carbon credit related information, such as account balance, rate of carbon credit usage, currently applicable “cost” for carbon credit usage. Notifications can be provided to the consumer if any of this information crosses a threshold value. In addition, or alternatively, the carbon credit related information can be used to automatically control the operation of devices that consume electrical energy.

Owner:SILVER SPRING NETWORKS

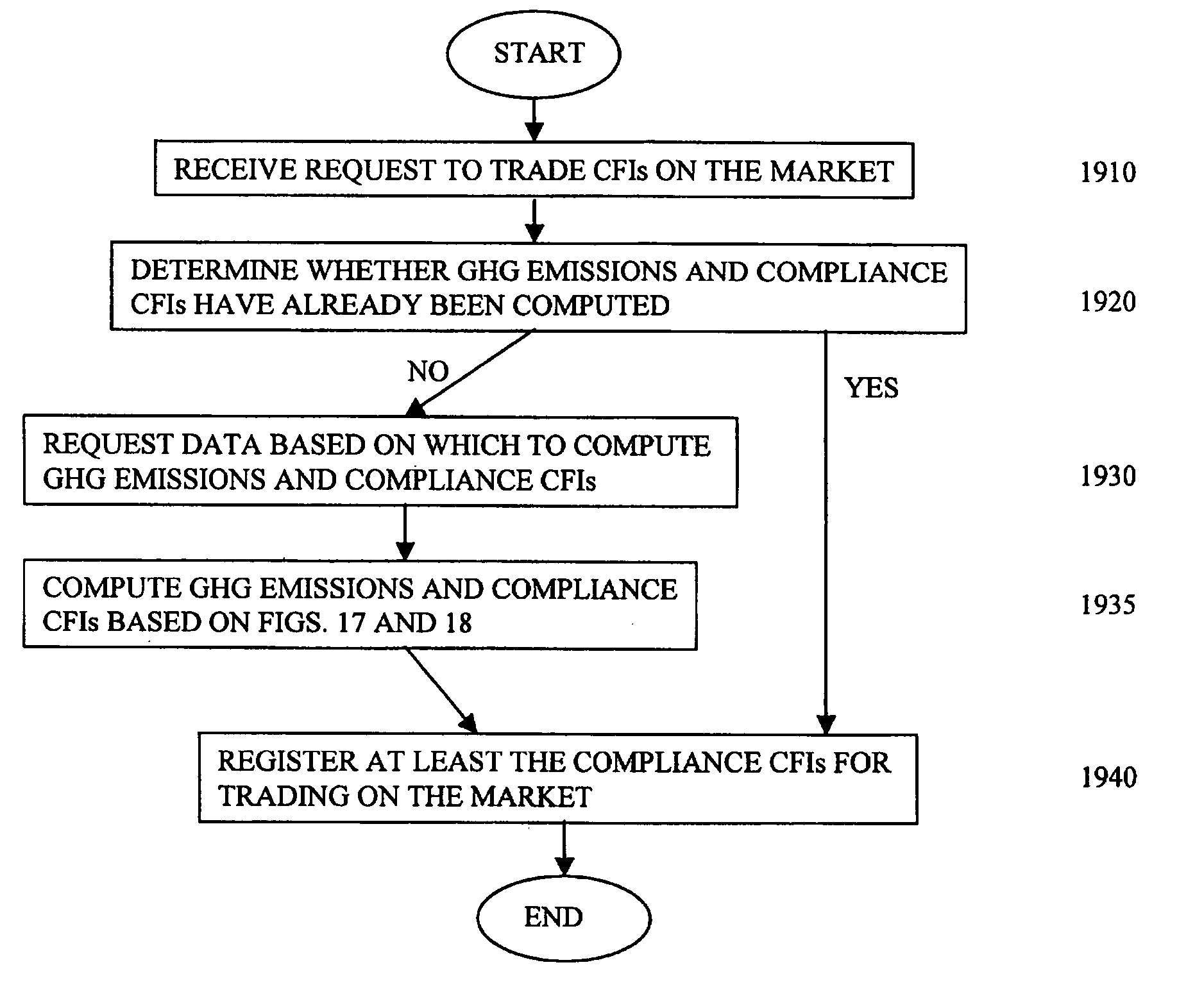

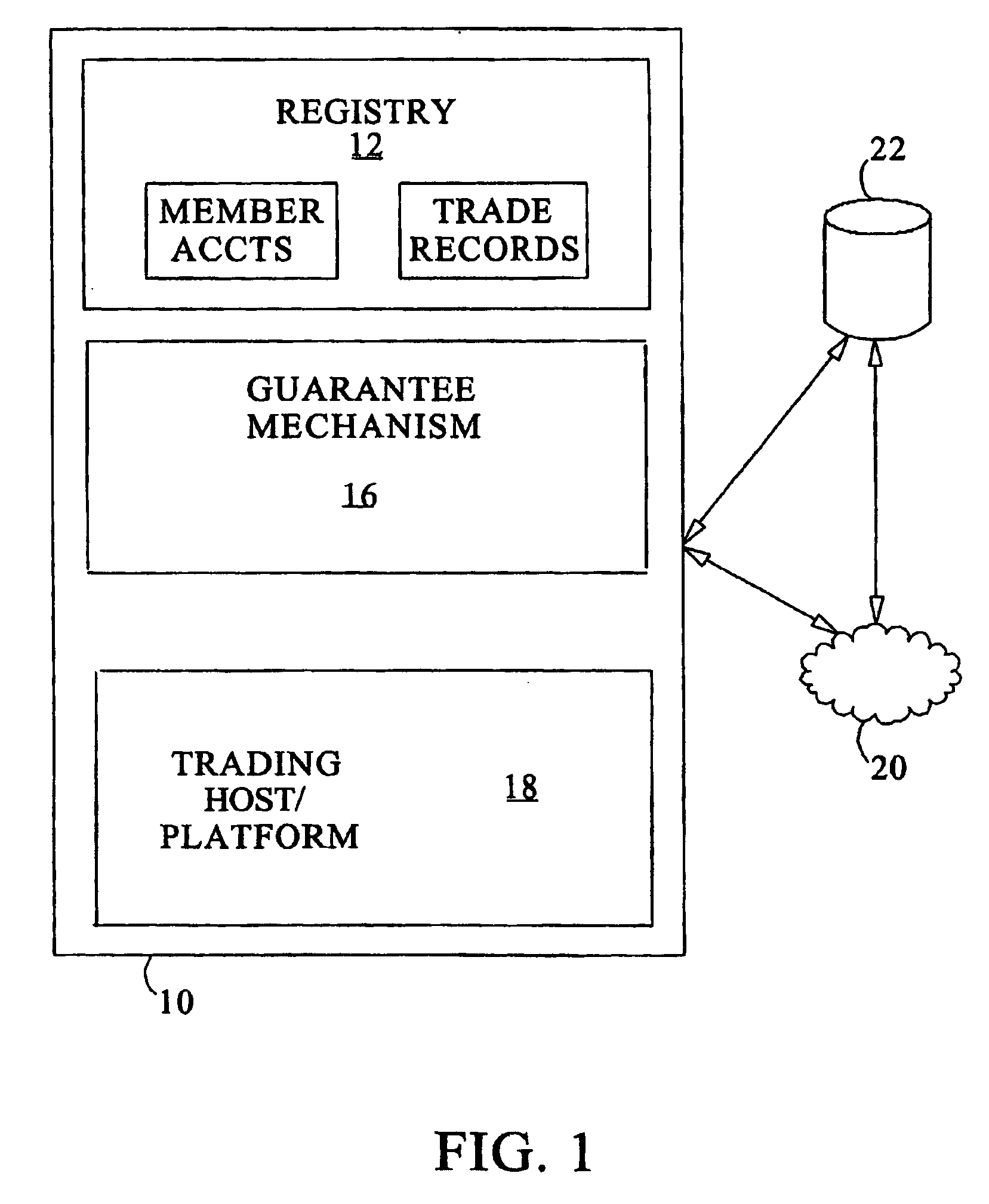

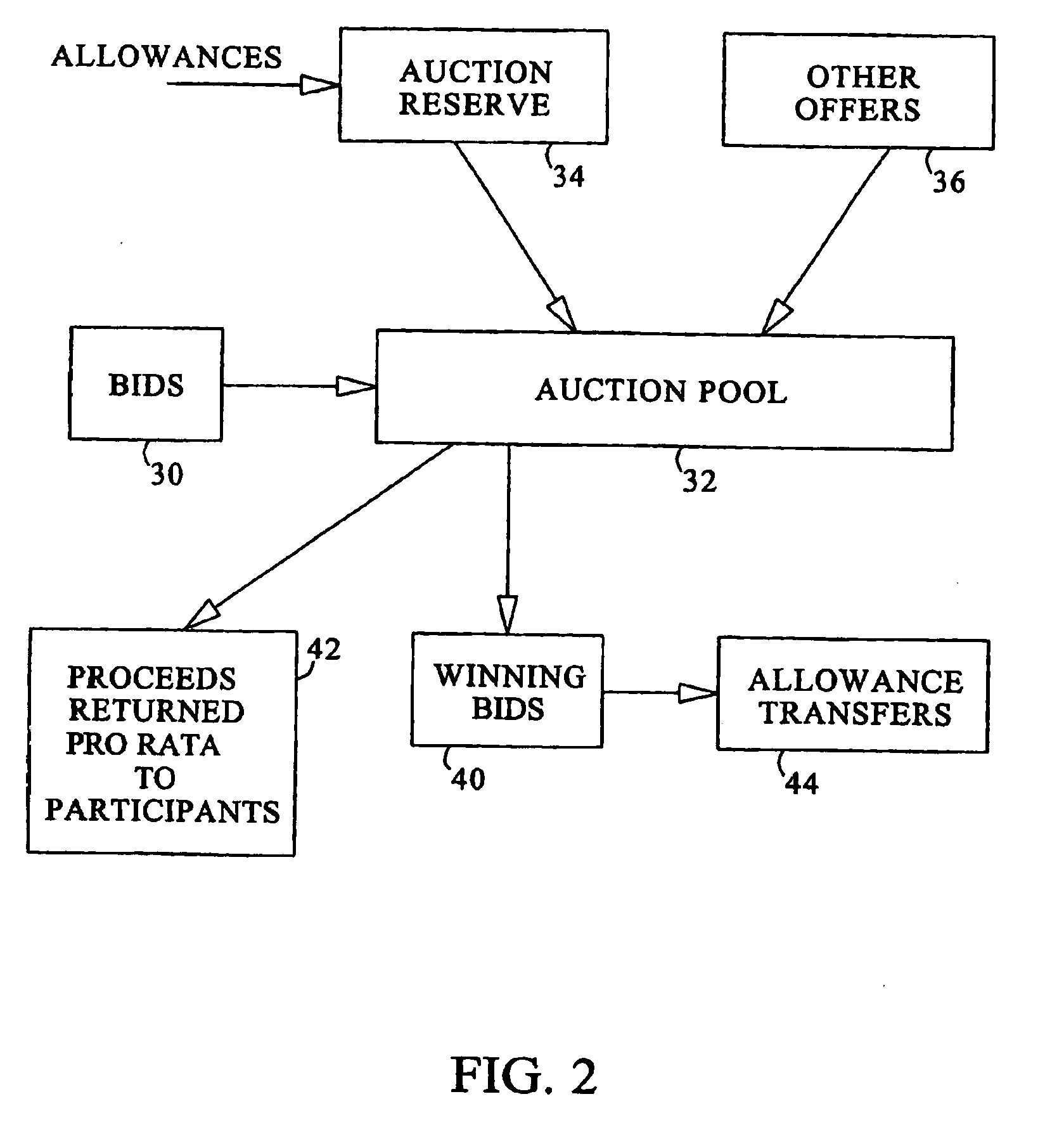

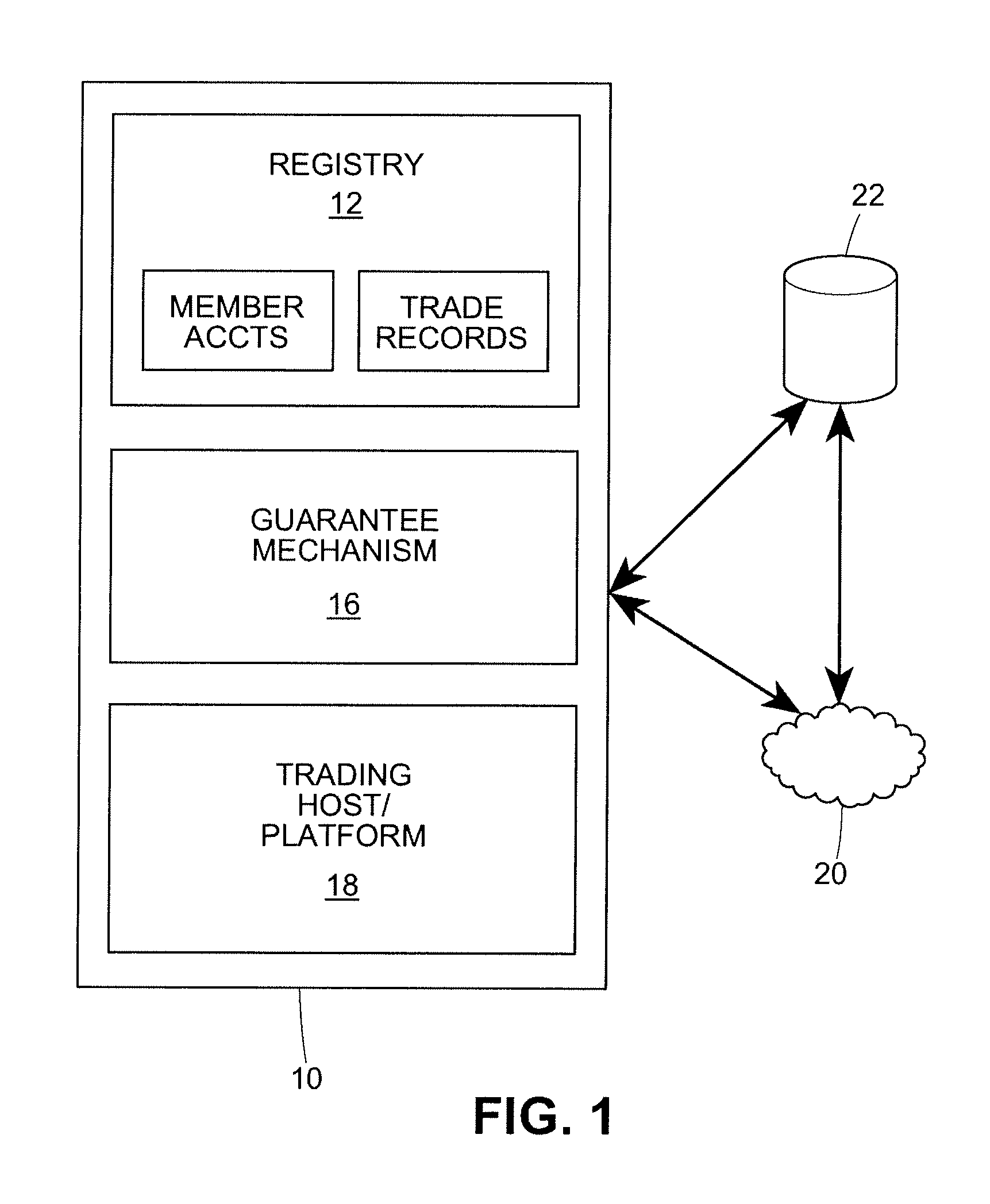

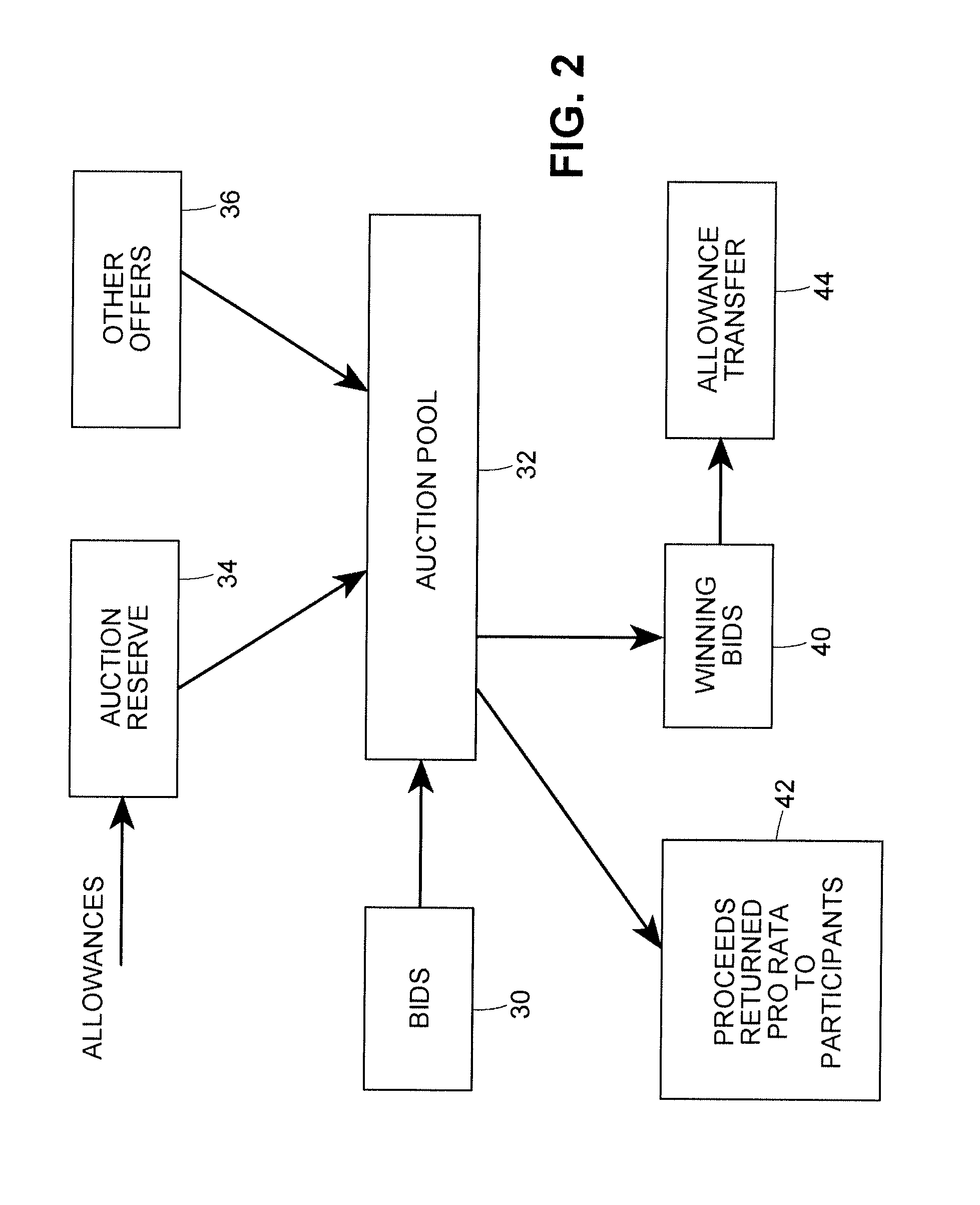

Systems and methods for trading emission reductions

InactiveUS20060184445A1Facilitates tradeAvoid problemsFinanceTechnology managementTime scheduleProgram planning

Systems and methods for facilitating trading of emission allowances and offsets among participants are described. In some embodiments, methods of facilitating such trading include establishing an emissions reduction schedule for certain participants based on emissions information provided by those participants; determining debits or credits for each certain participant in order to achieve the reduction schedule; creating financial instruments representing such debits and credits; and conducting trades of such financial instruments to transfer emission debits and credits between the participants to enable the certain participants to meet the reduction schedule. Also, trades of emission debits and credits are conducted between the participants to enable the certain participants to meet the reduction schedule. The systems of the invention are computer based and are linked via the internet to enable real time operation of the trading system to facilitate buying and selling of emission financial instruments by the participants.

Owner:CHICAGO CLIMATE EXCHANGE

Methods of operating a coal burning facility

ActiveUS20070168213A1Improve balanceIncrease valueSustainable waste treatmentSolid fuel pretreatmentHalogenSorbent

Methods involve adding sorbent components, such as calcium oxide, alumina, and silica, as well as optional halogens as part of environmental control. Use of the sorbents leads to significant reductions in sulfur and mercury emissions that otherwise would result from burning coal. Use of the sorbents leads to production of waste coal ash that, while higher in mercury, is nevertheless usable as a commercial product because the mercury in the ash is non-leaching and because the coal ash has a higher cementitious nature by virtue of the increased content of the sorbent components in the ash. Thus, the methods involve adding powders having qualities that lead to the production of a cementitious coal ash while at the same time reducing emissions from a coal burning facility.

Owner:NOX II LTD

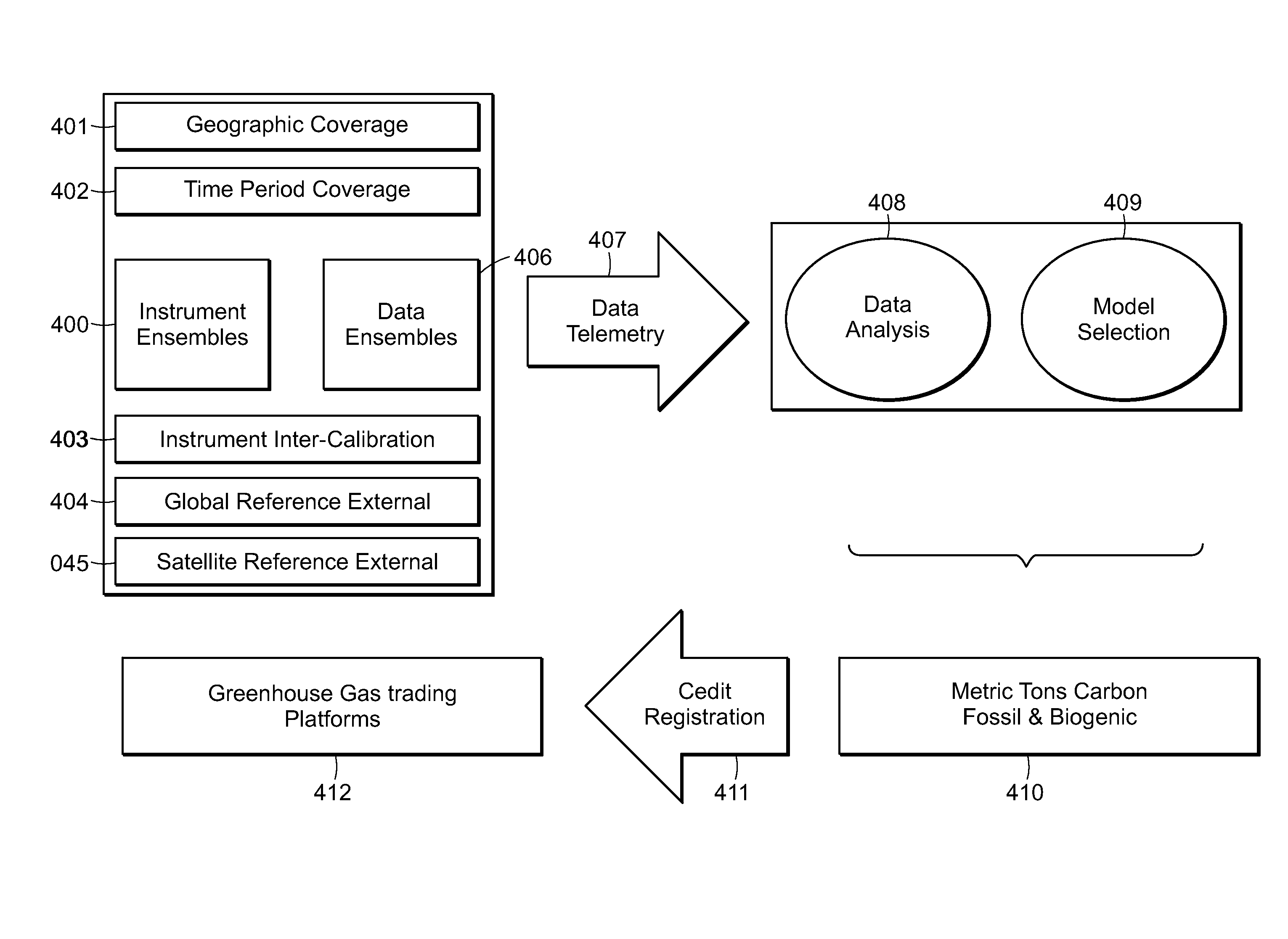

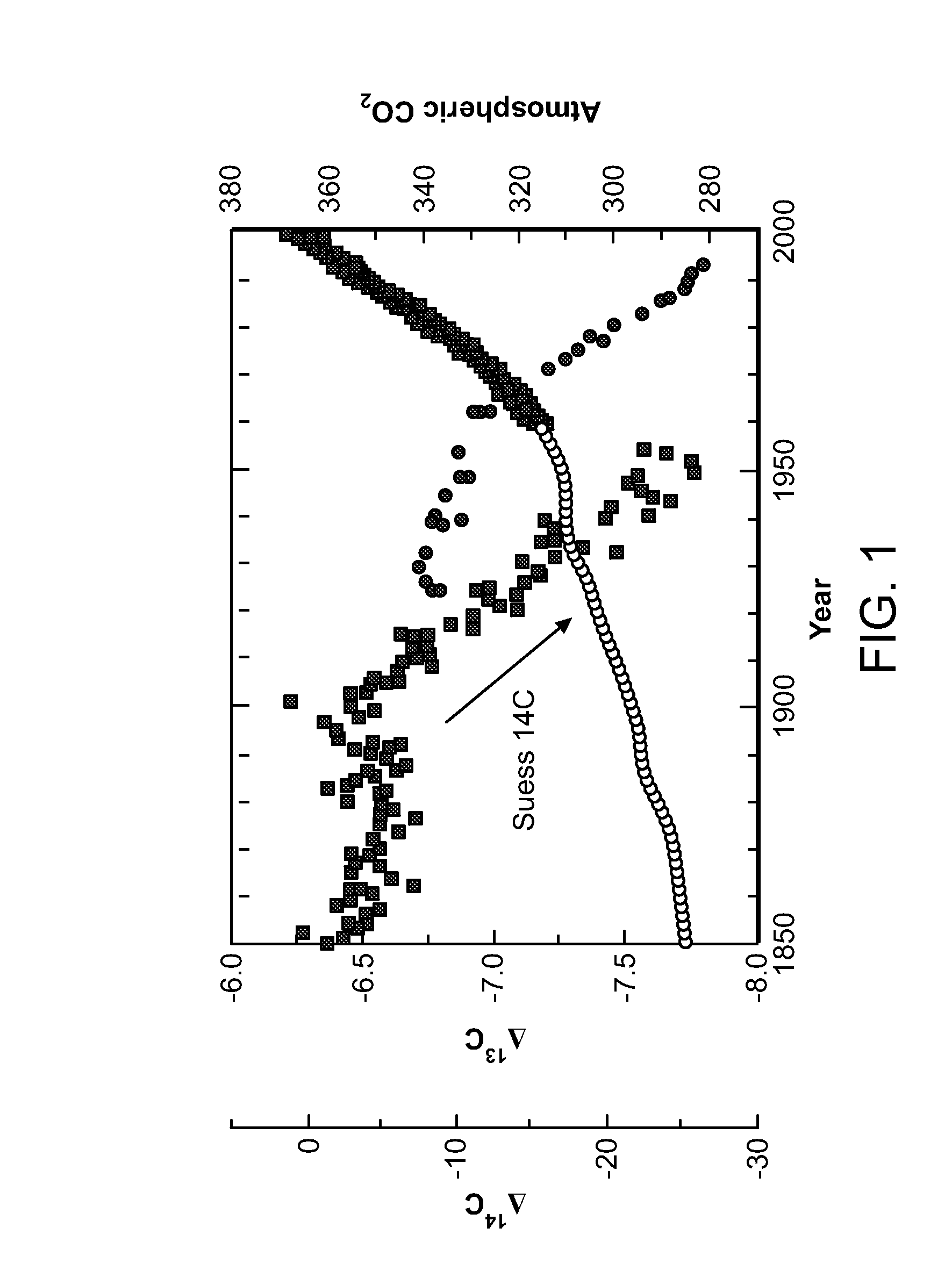

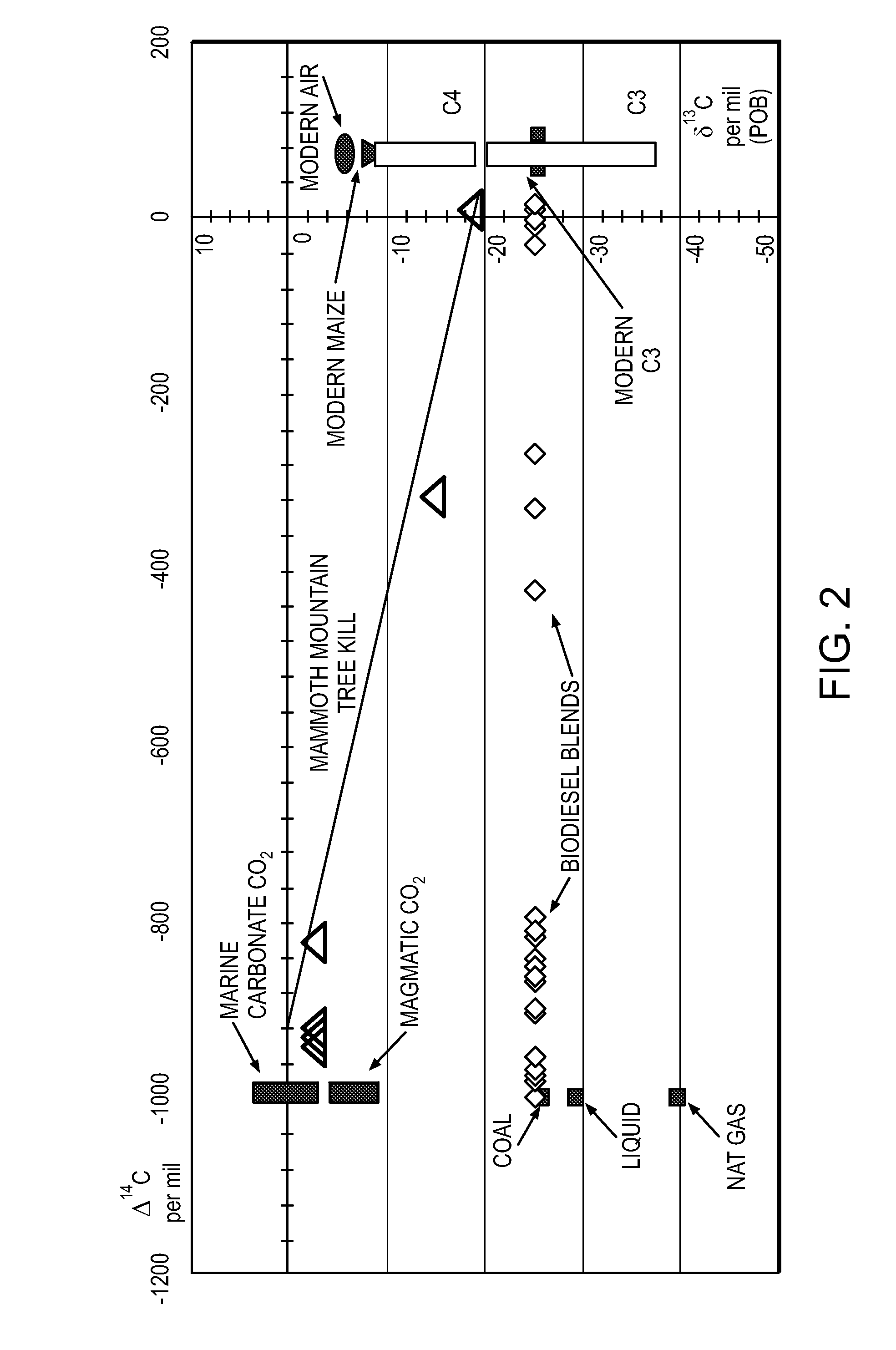

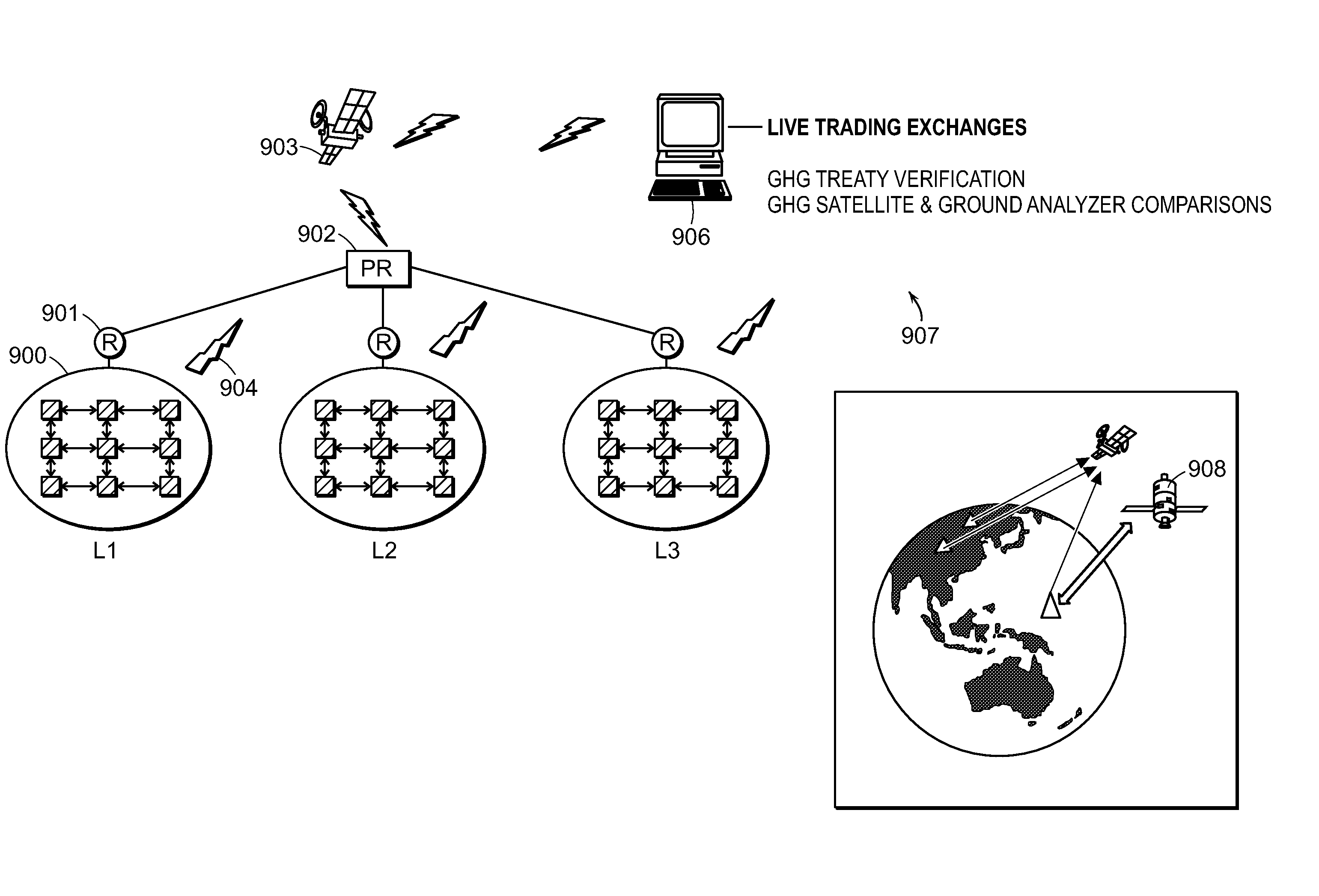

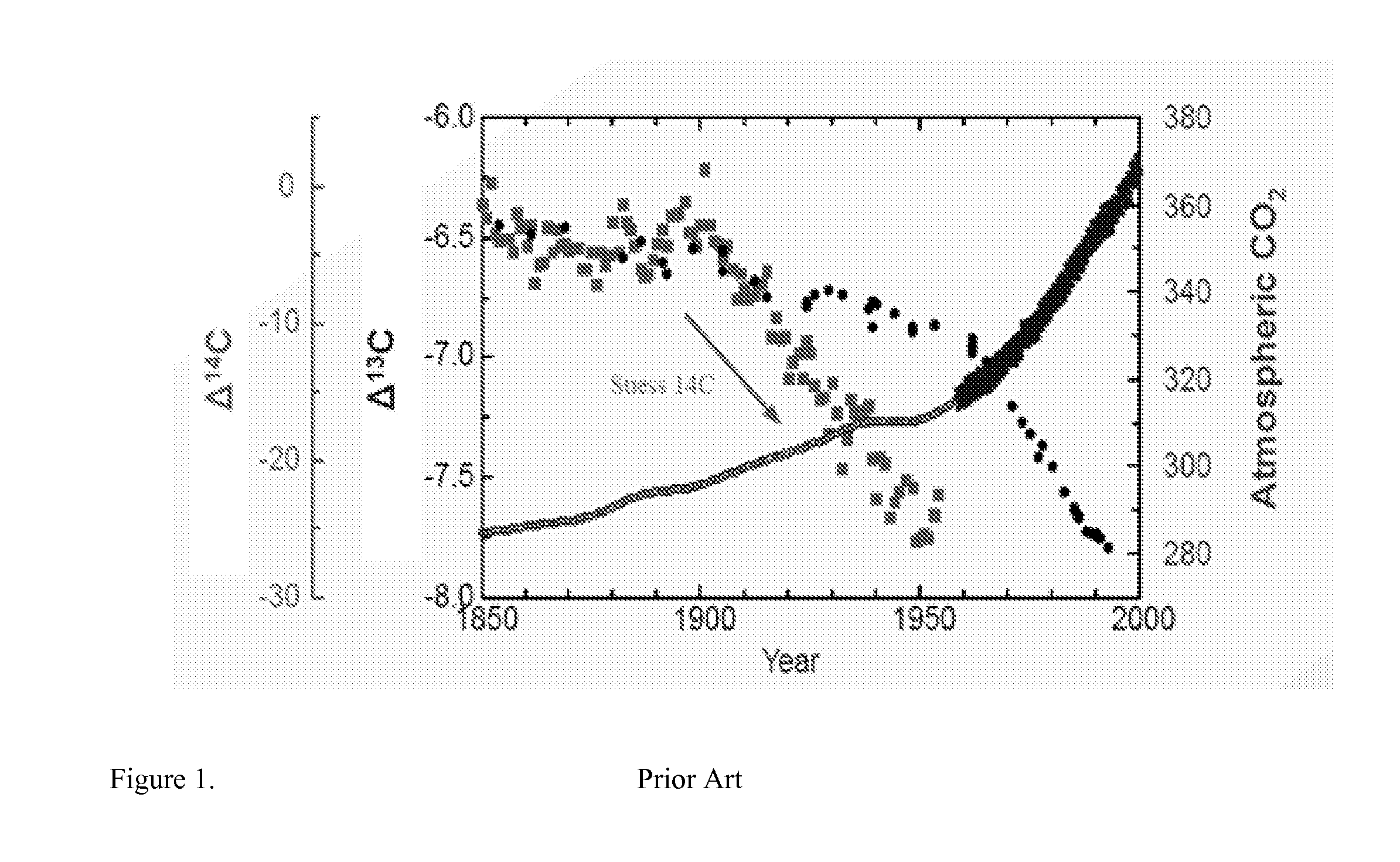

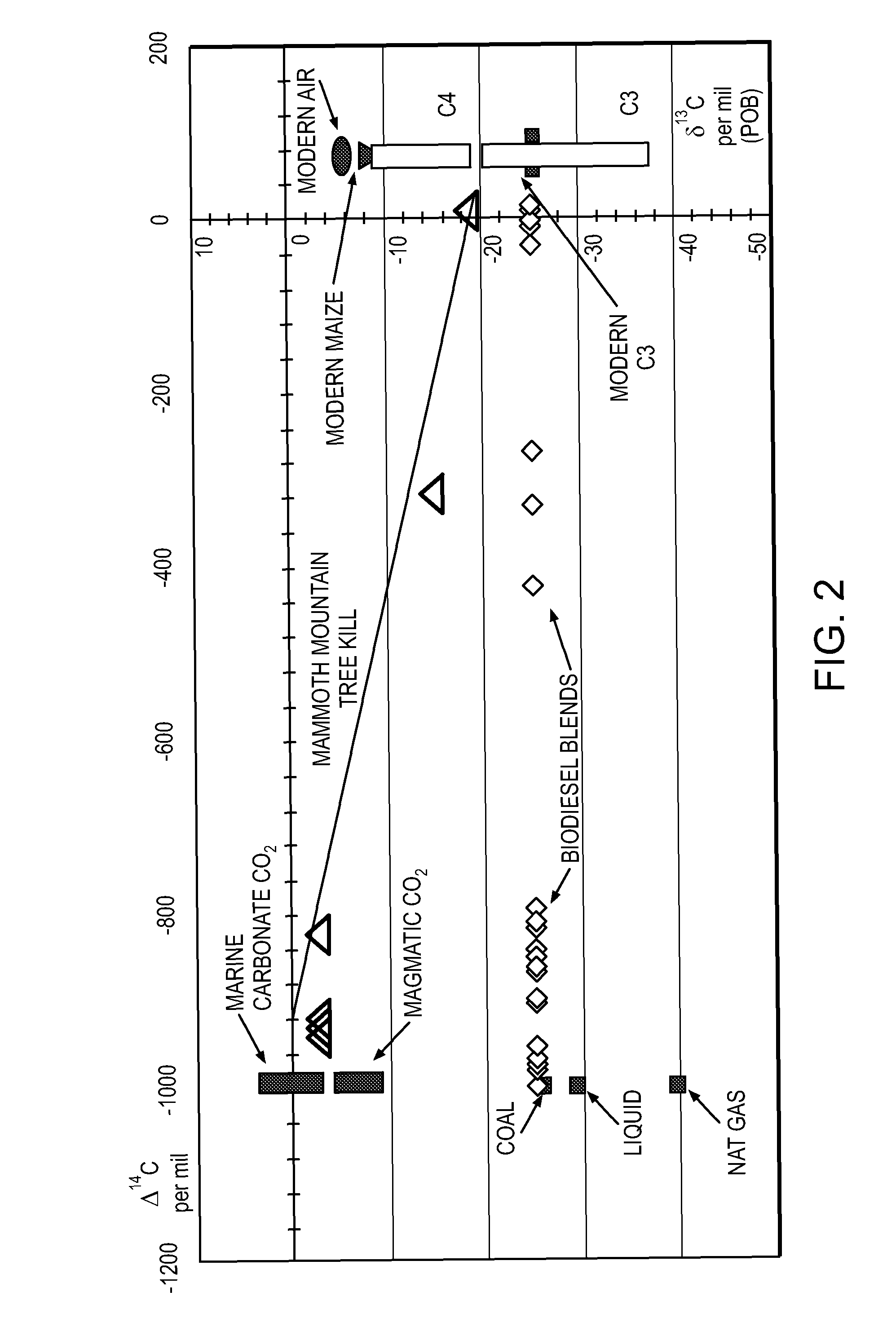

System of systems for monitoring greenhouse gas fluxes

ActiveUS20100198736A1High precisionReduce uncertaintySustainable waste treatmentCarbon compoundsNatural sourceGreenhouse gas flux

A system of systems to monitor data for carbon flux, for example, at scales capable of managing regional net carbon flux and pricing carbon financial instruments is disclosed. The system of systems can monitor carbon flux in forests, soils, agricultural areas, body of waters, flue gases, and the like. The system includes a means to identify and quantify sources of carbon based on simultaneous measurement of isotopologues of carbon dioxide, for example, industrial, agricultural or natural sources, offering integration of same in time and space. Carbon standards are employed at multiple scales to ensure harmonization of data and carbon financial instruments.

Owner:PLANETARY EMISSIONS MANAGEMENT

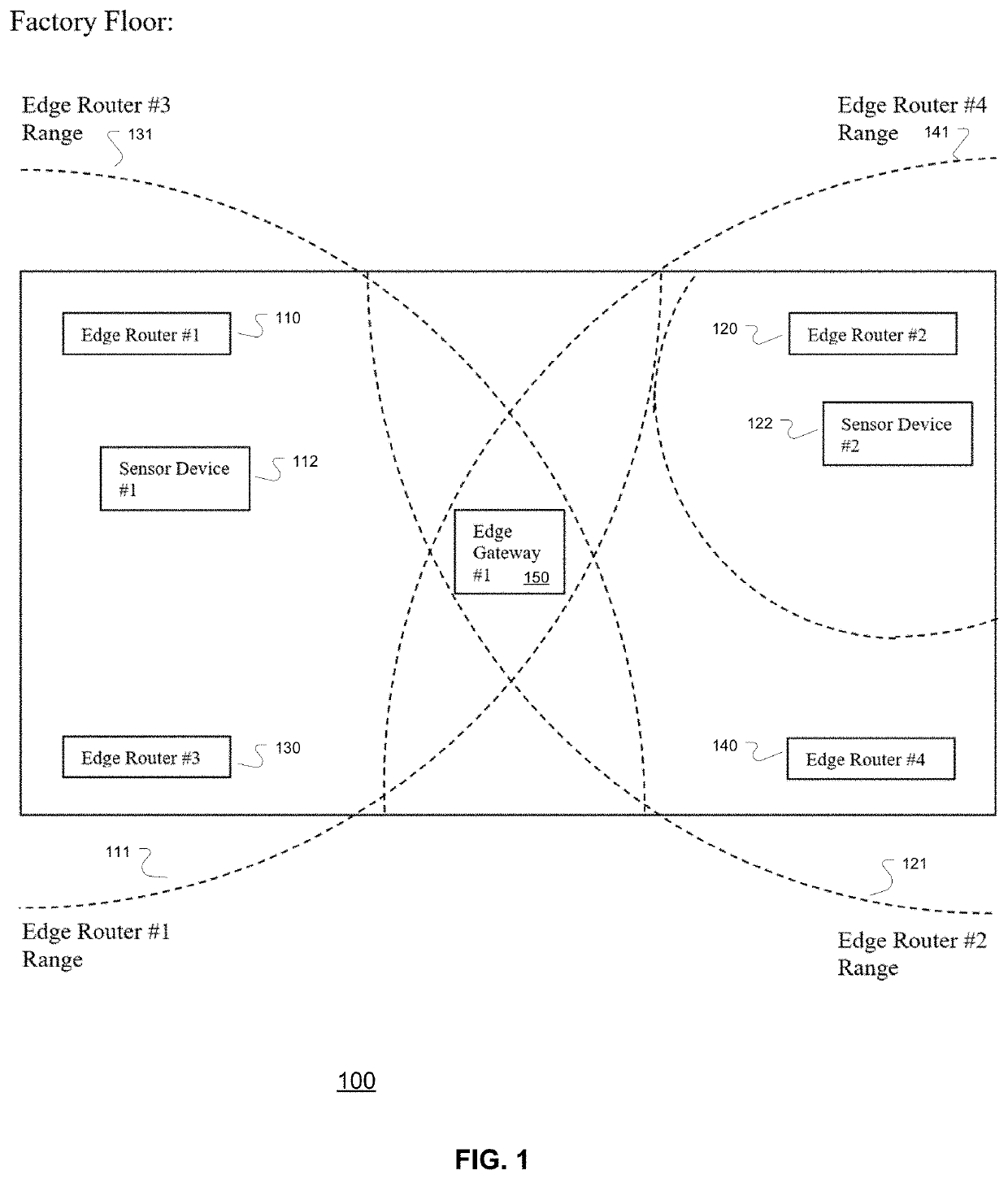

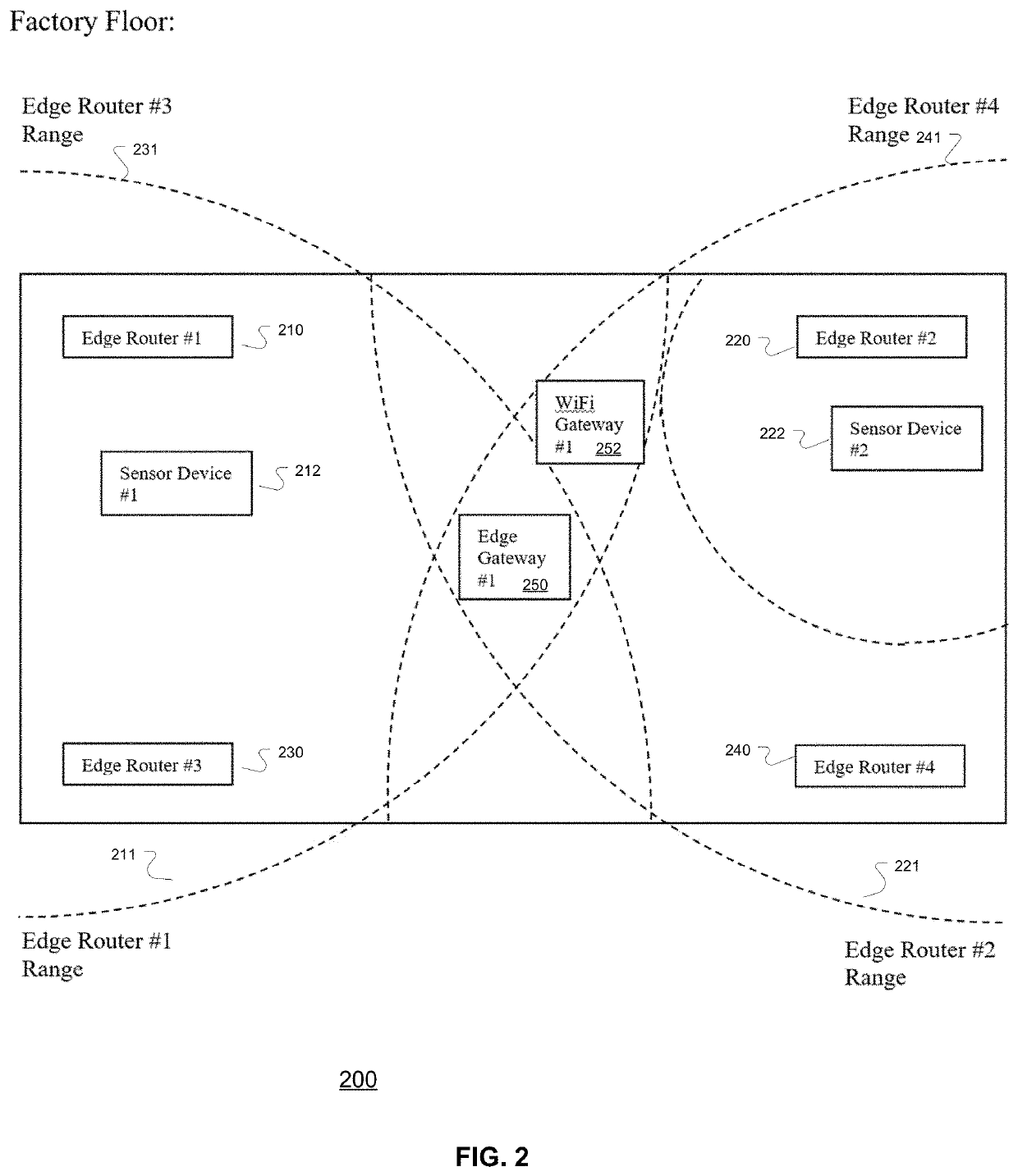

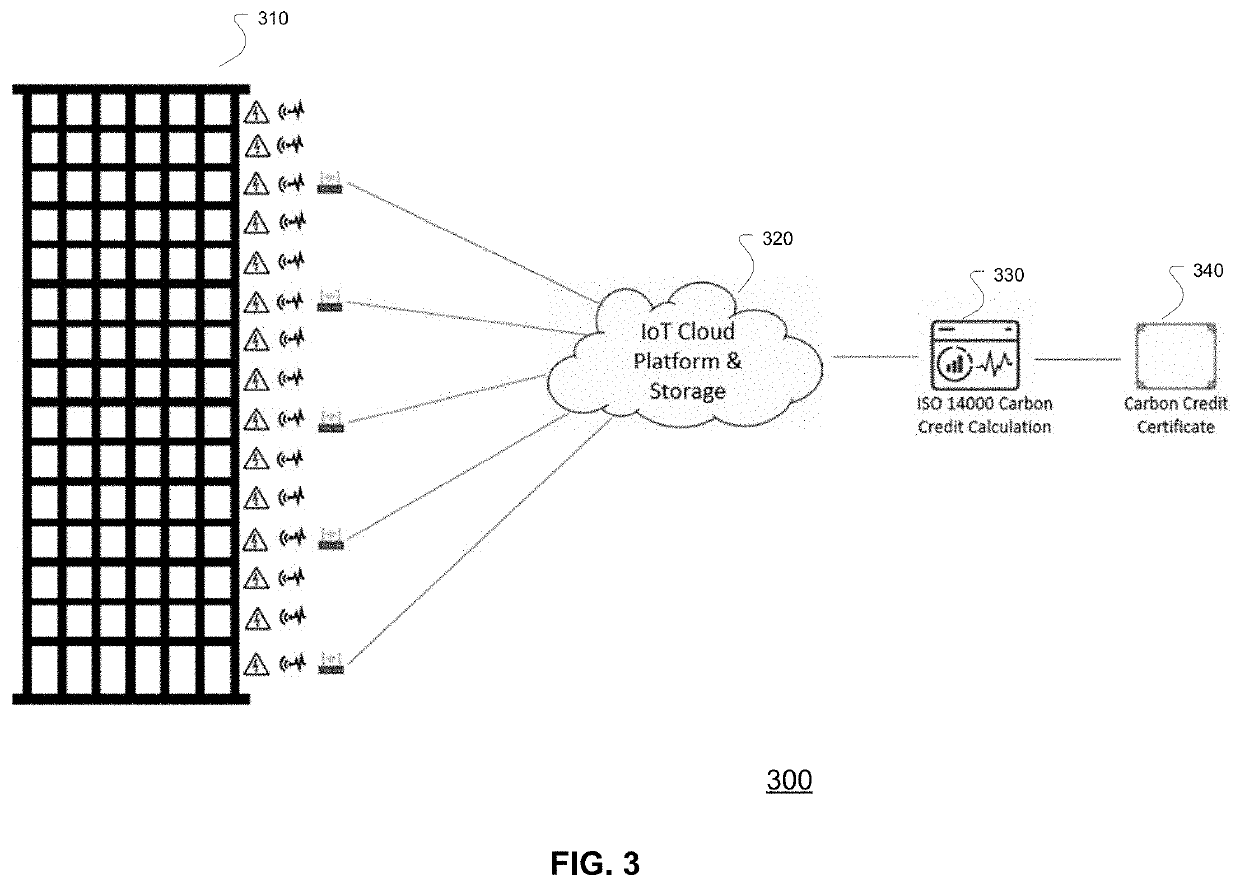

System, business and technical methods, and article of manufacture for utilizing internet of things technology in energy management systems designed to automate the process of generating and/or monetizing carbon credits

InactiveUS20200027096A1Improve operator safetyImprove user experienceFinancePayment protocolsEnvironmental resource managementCarbon dioxide equivalent

A carbon credit is a generic term for any tradable certificate or permit representing the right to emit one ton of carbon dioxide or the mass of another greenhouse gas with a carbon dioxide equivalent (tCO2e) equivalent to one ton of carbon dioxide.Carbon credits and carbon markets are a component of national and international attempts to mitigate the growth in concentrations of greenhouse gases (GHGs). One carbon credit is equal to one ton of carbon dioxide, or in some markets, carbon dioxide equivalent gases. Carbon trading is an application of an emissions trading approach. Greenhouse gas emissions are capped and then markets are used to allocate the emissions among the group of regulated sources.Carbon credits can be generated by any process that conforms to ISO 14064-66 standards. Once generated, carbon credits can be stored in a distributed, Cloud-based ledger. The ledger entries can serve as a registry for carbon credits as well as the data source for an Internet-enabled trading system or financial exchange that allows the carbon credits to be sold and bought as part of the same system. The distributed ledger can provide records that combine the details of the carbon credits' origin, transaction history, and financial instructions associated with trading of the carbon credits via a distributed ledger system.

Owner:COONER JASON RYAN

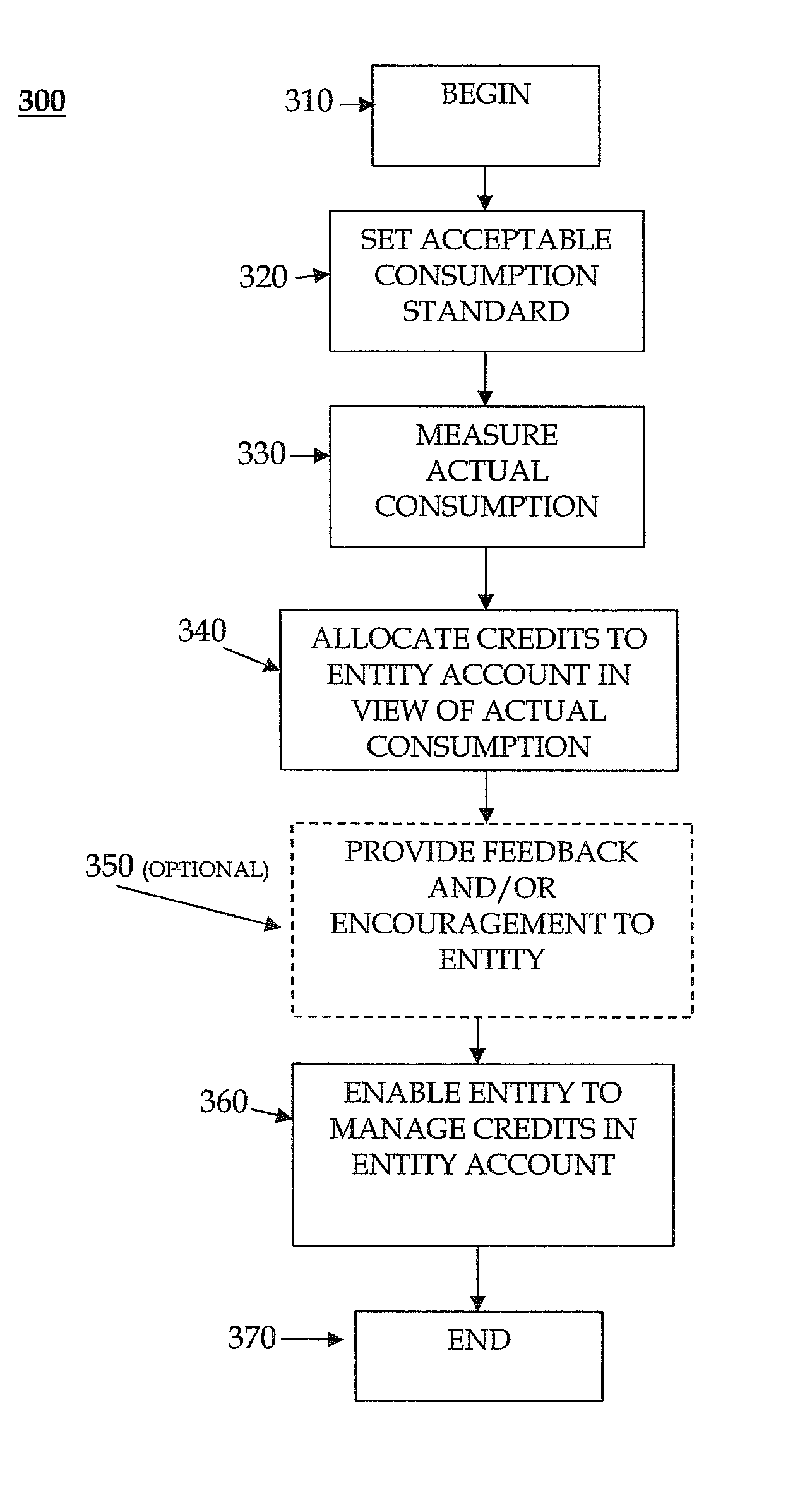

System and method for incentive-based resource conservation

InactiveUS20100121700A1Encourage environmentally-conscious behaviorReduce and minimize useComplete banking machinesAcutation objectsThird partyResource protection

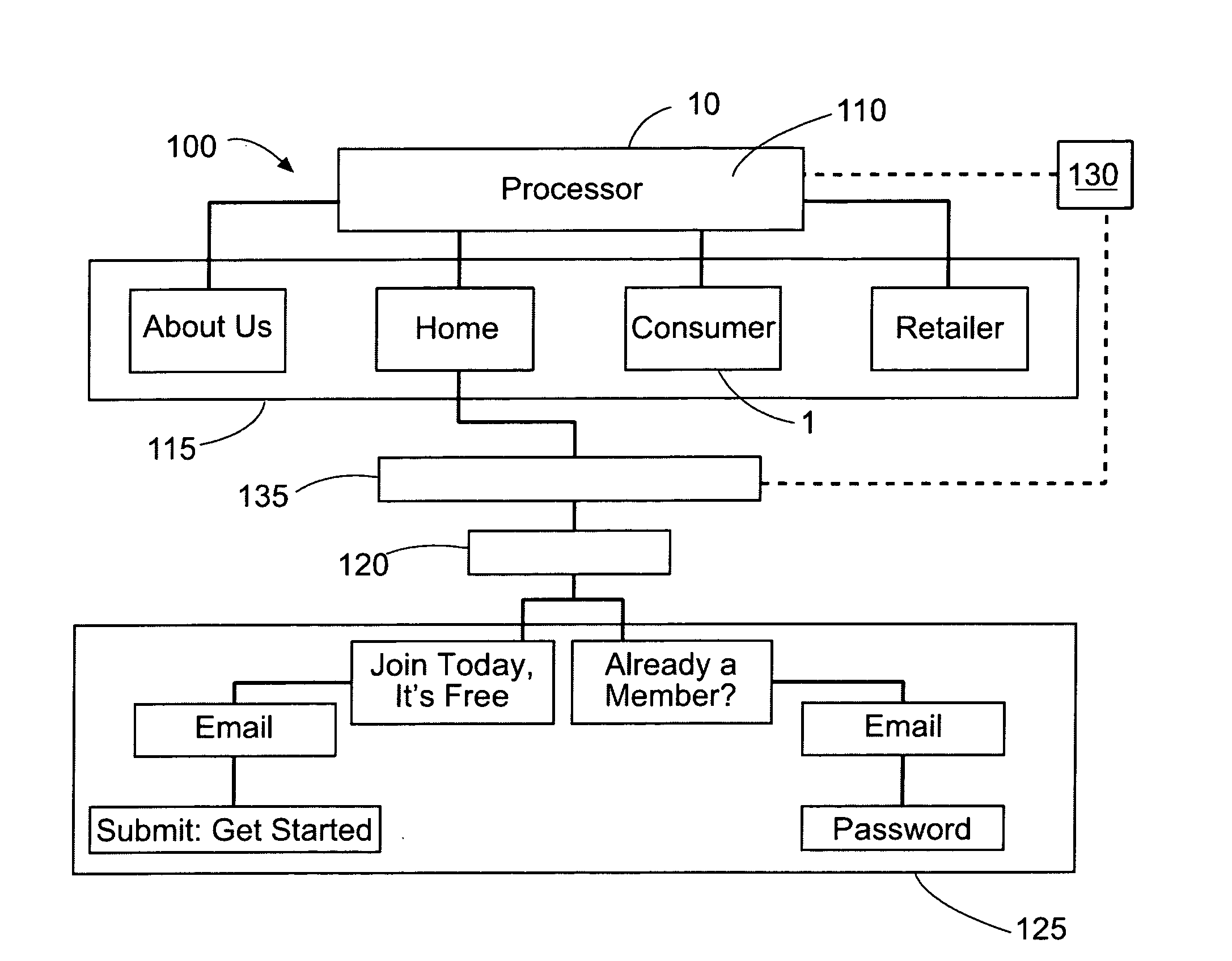

Embodiments of the present invention generally relate to a system and method for administering an incentive-based program to encourage environmentally-conscious behavior. In one embodiment, a method for administering an incentive-based program to encourage environmentally-conscious behavior comprises providing a network-accessible database, hosted by an administrator, having a plurality of sets of records, each set of records corresponding to a user, monitoring an environmentally-conscious behavioral activity of a first user, and recording a record of the behavioral activity in the database, using a computer-based mathematical calculation to translate the record of the behavioral activity to a value, and storing the value within a record of a set of records corresponding to the first user, and allowing the first user to access the database, using a computing device to communicate through a data portal to the database via a network, to redeem the value for a credit at a third party retailer.

Owner:RECYCLEBANK

System that varies the terms and conditions of a subsidized loan

ActiveUS20200302523A1Easy to learnMarket predictionsDiscounts/incentivesFinancial transactionSmart contract

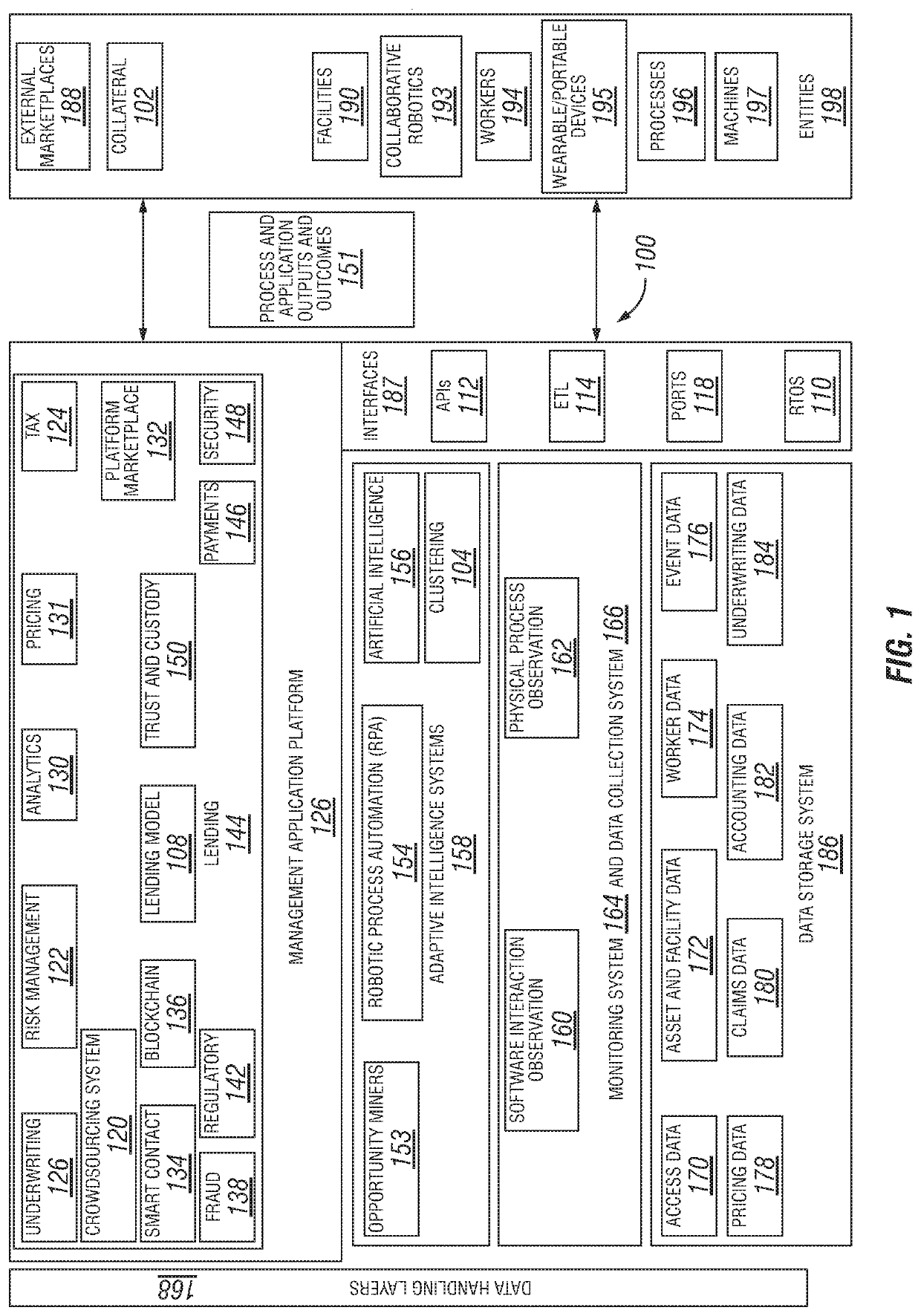

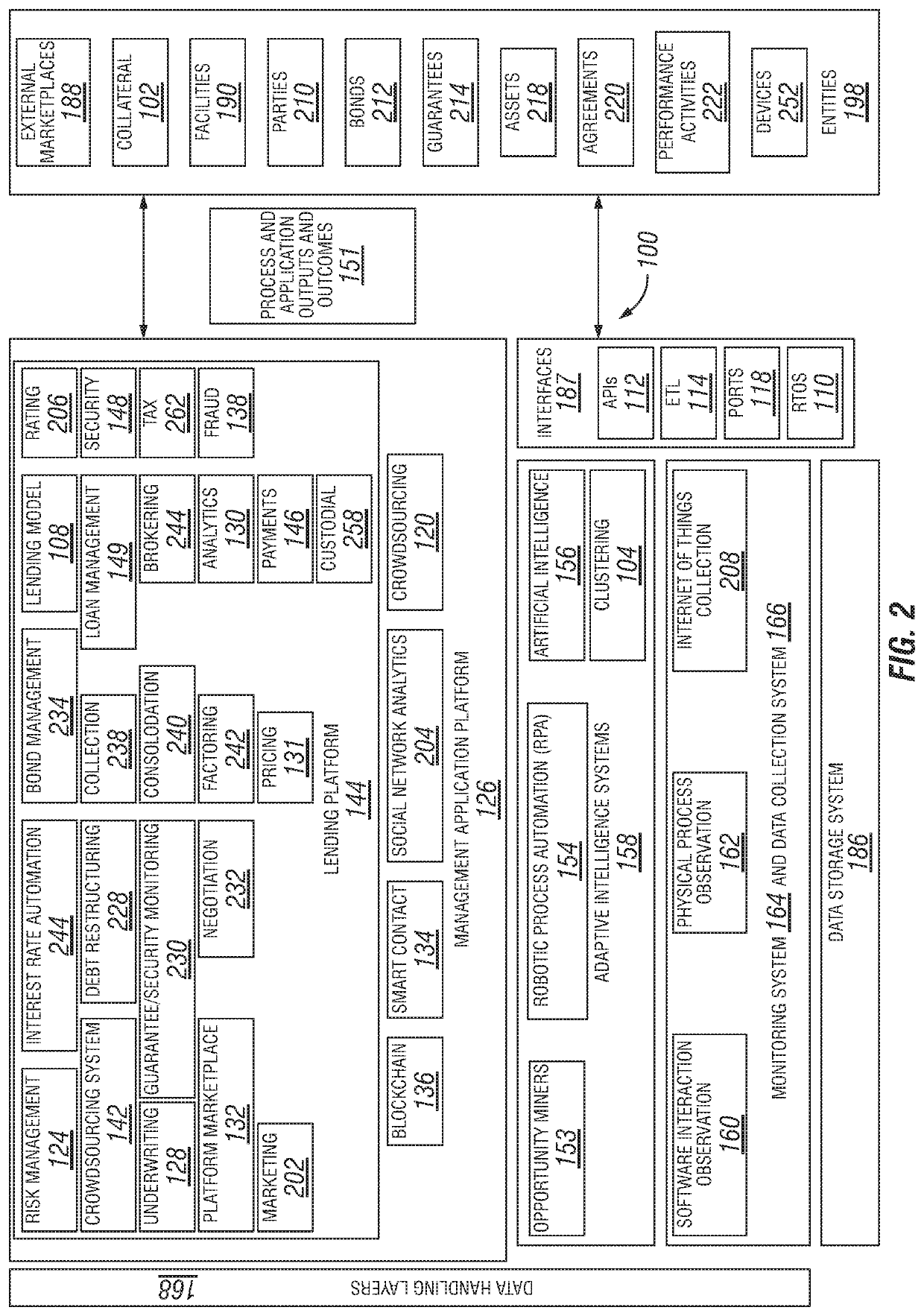

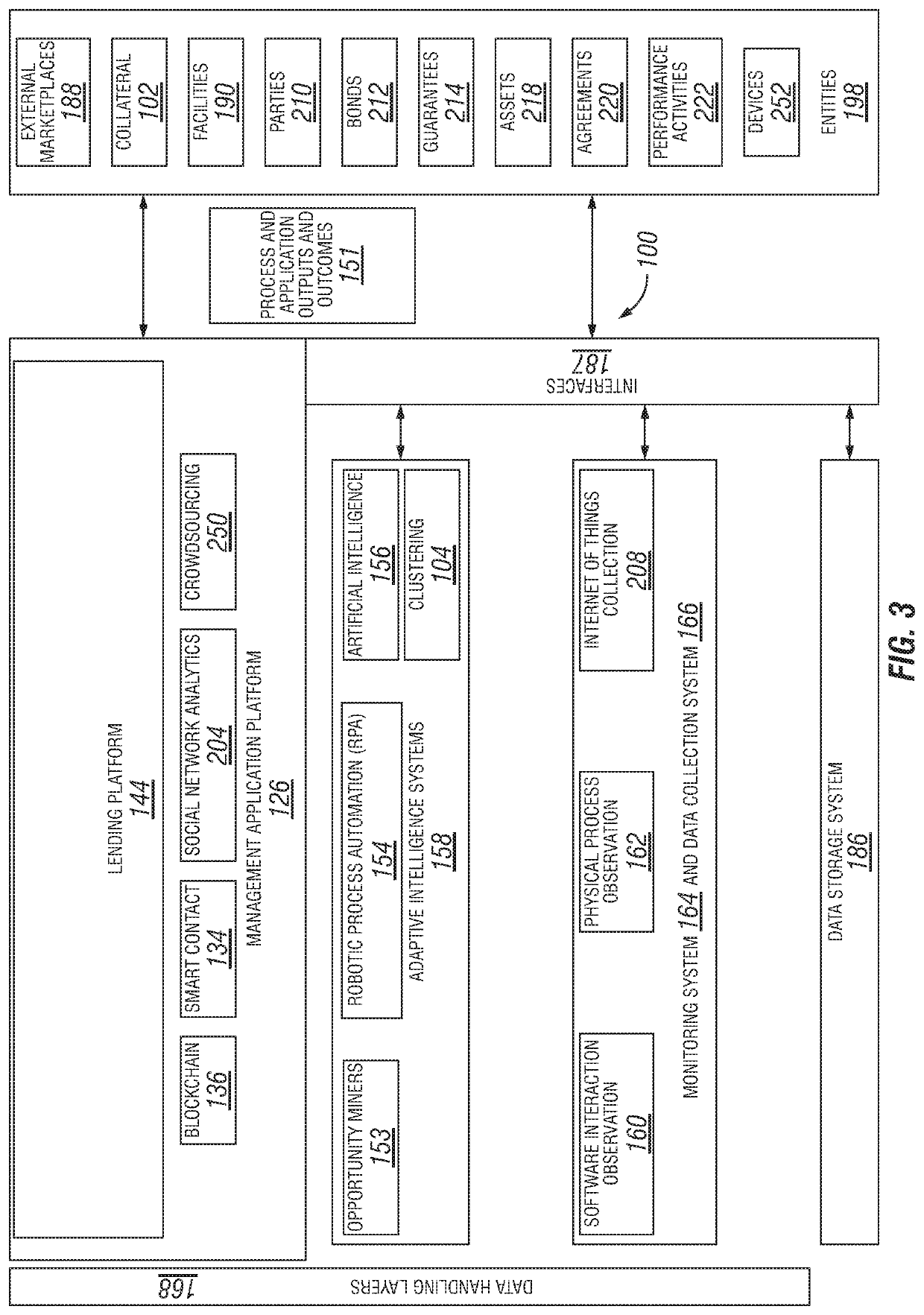

A system that varies the terms and conditions of a subsidized loan includes a blockchain service circuit structured to interpret a plurality of access control features corresponding to a plurality of parties associated with a loan; a data collection circuit structured to interpret entity information corresponding to a plurality of entities related to a lending transaction corresponding to the loan; a smart contract circuit structured to specify loan terms and conditions relating to the loan; and a loan management circuit structured to interpret loan related events in response to the entity information, the plurality of access control features, and the loan terms and conditions, wherein the loan related events are associated with the loan; and implement loan related activities in response to the entity information, the plurality of access control features, and the loan terms and conditions, wherein the loan related activities are associated with the loan.

Owner:STRONG FORCE TX PORTFOLIO 2018 LLC

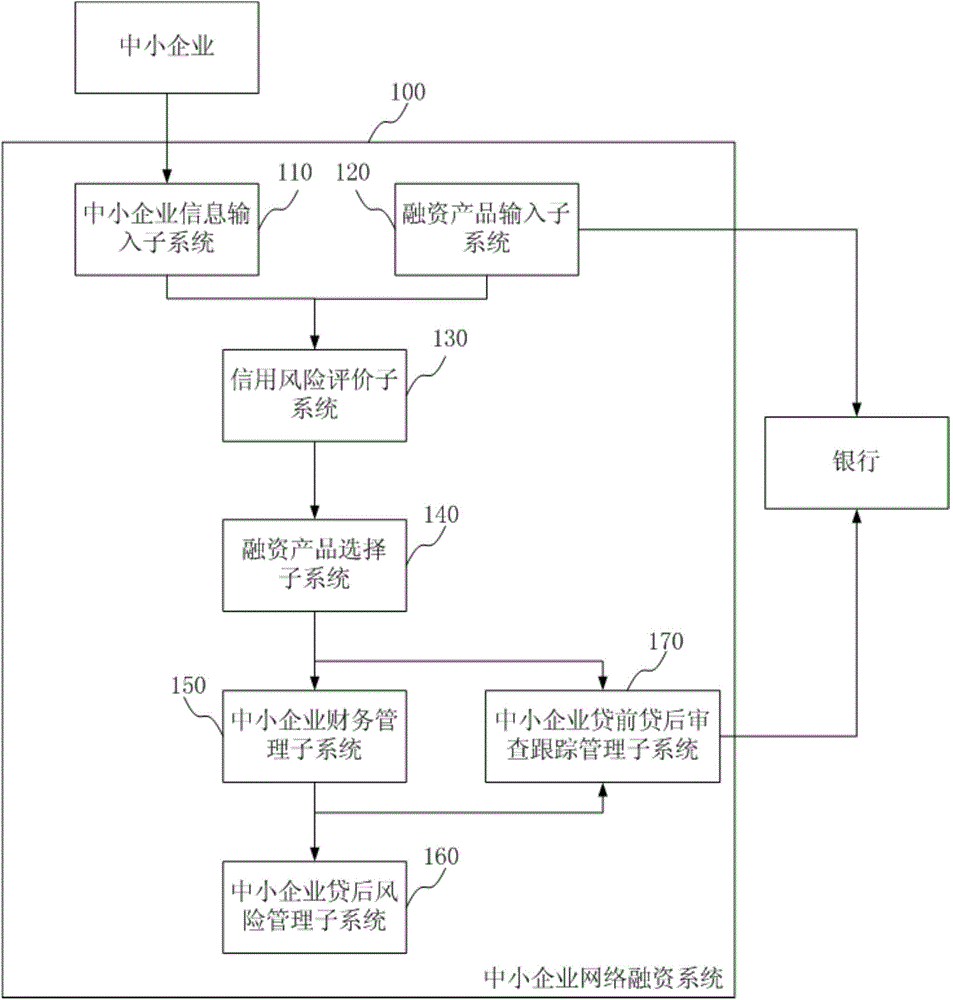

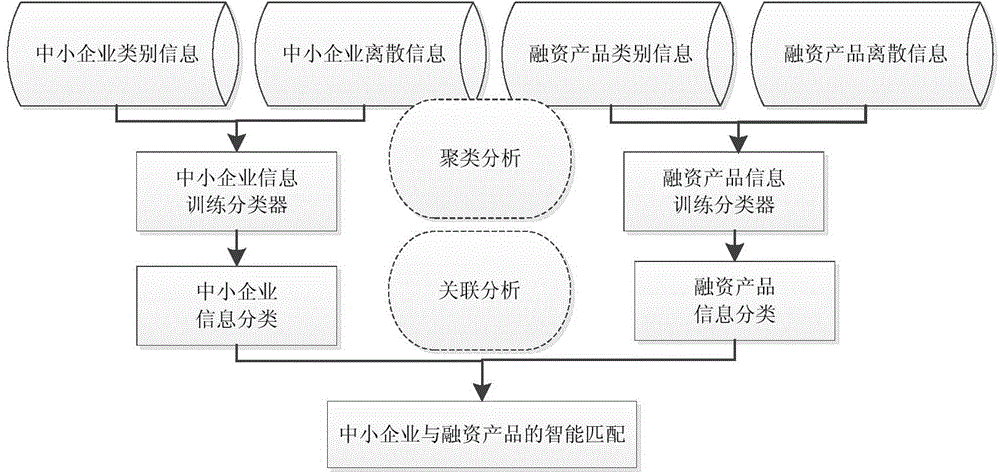

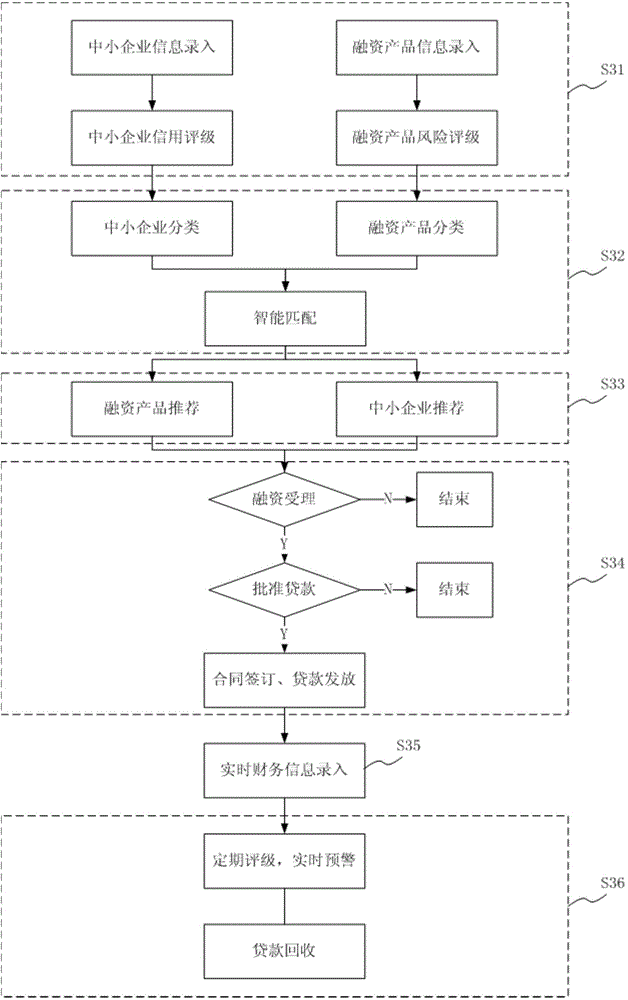

Small and medium-sized enterprise network financing system and method

InactiveCN104361463AImprove financing efficiencySolve financing difficultiesFinanceFinancial managementProduct selectionKnowledge management

The invention provides a small and medium-sized enterprise network financing system and method. The system comprises a small and medium-sized enterprise information input subsystem, a financing product input subsystem, a credit risk evaluation subsystem, a financing product selection subsystem, a small and medium-sized enterprise financial management subsystem and a small and medium-sized enterprise post-loan risk management subsystem. The small and medium-sized enterprise information input subsystem carries out the input of small and medium-sized enterprise basic information and small and medium-sized enterprise financial information; the financing product input subsystem carries out input of financing product information; the credit risk evaluation subsystem carries out credit risk rating on small and medium-sized enterprises and financing products through a small and medium-sized enterprise credit rating module and a financing product risk rating module; the financing product selection subsystem intelligently selects corresponding small and medium-sized enterprises and financing products; the small and medium-sized enterprise financial management subsystem carries out the input of financial revenue and expenditure data of the post-loan small and medium-sized enterprises; the small and medium-sized enterprise post-loan risk management subsystem carries out post-loan risk evaluation on the small and medium-sized enterprises regularly according to the financial revenue and expenditure data through the small and medium-sized enterprise credit rating module.

Owner:SHANGHAI IN RICH FINANCIAL SERVICES CO LTD

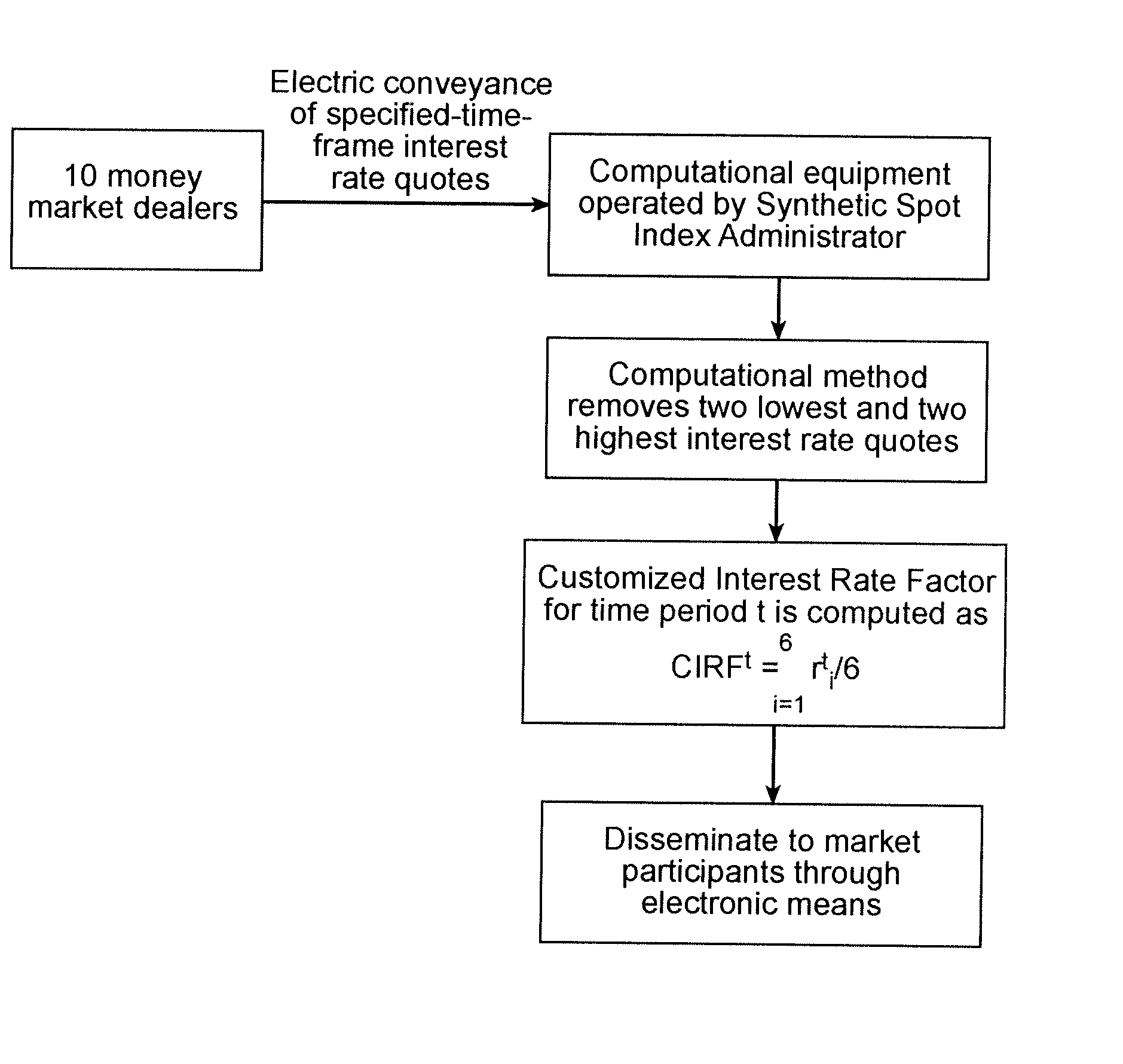

Present valuation of emission credit and allowance futures

InactiveUS20070192221A1Facilitating futures contract tradingFinanceFinancial managementComputer scienceExpiration date

The present invention is directed to a computer-operated method for determining the present value of a futures contract for a commodity. The method includes selecting an expiration date for the futures contract, calculating a customized interest rate factor based on interest rates surveyed from a plurality of lending institutions, and applying the customized interest rate factor to the futures contract price to determine the present value.

Owner:CHICAGO CLIMATE EXCHANGE

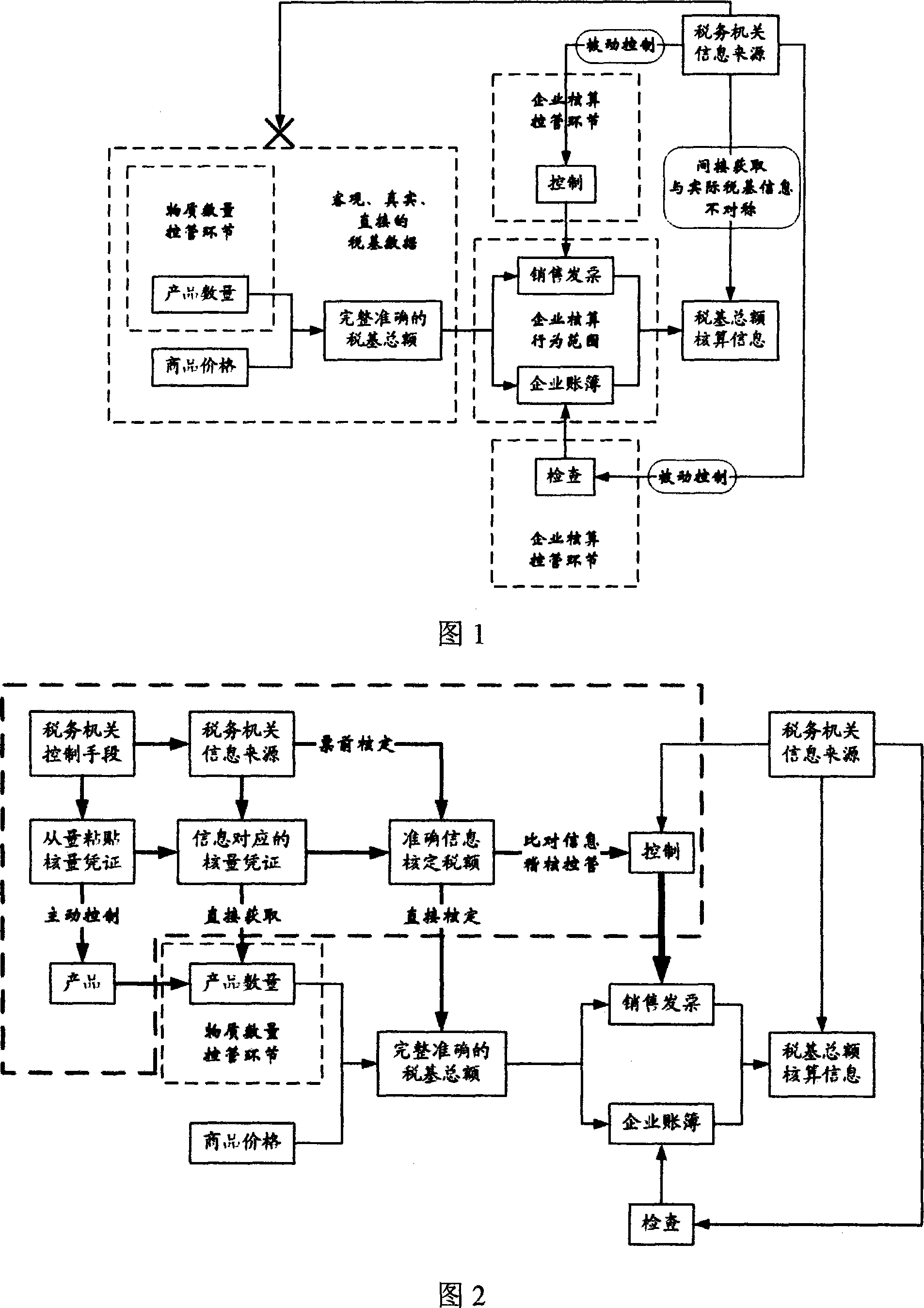

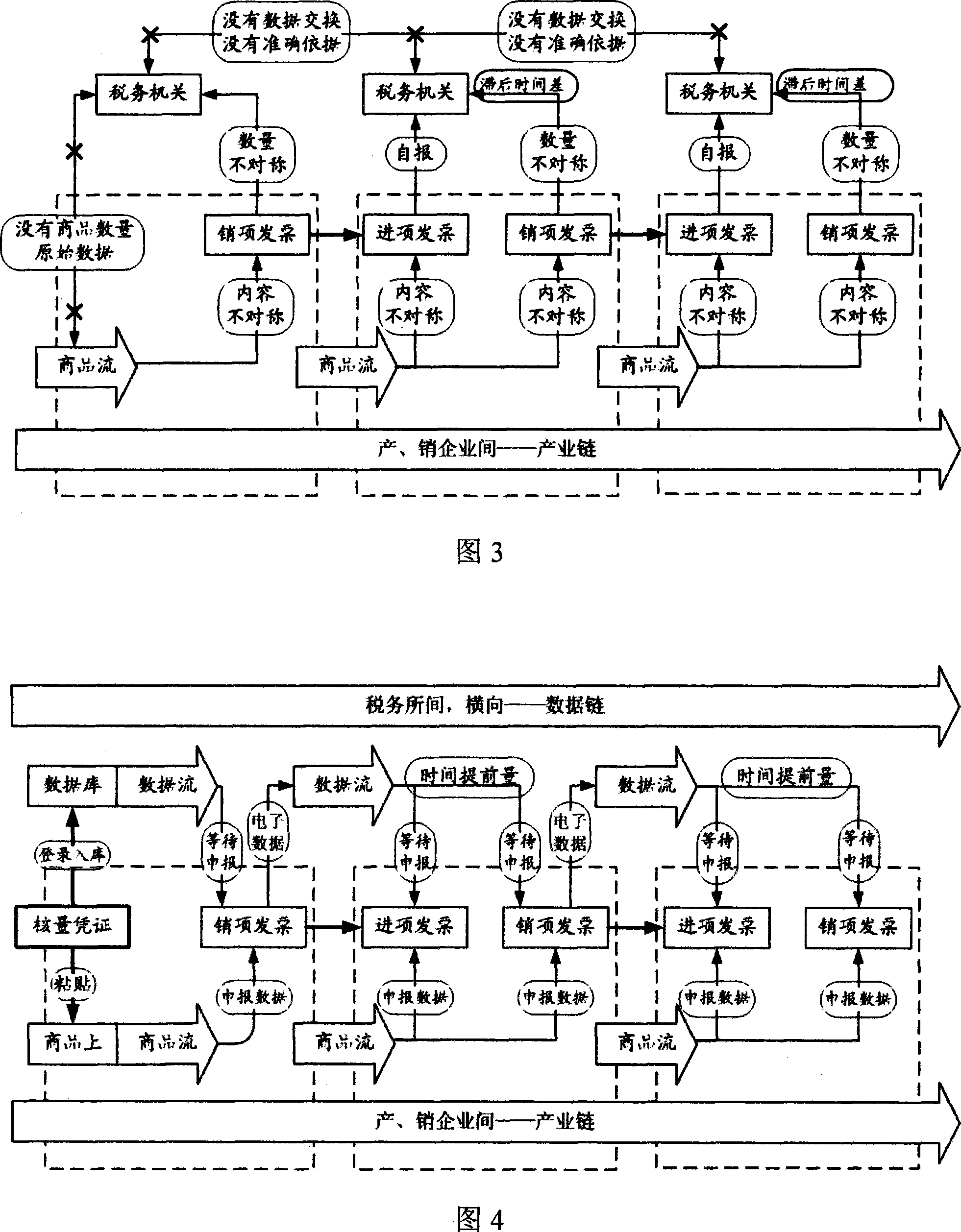

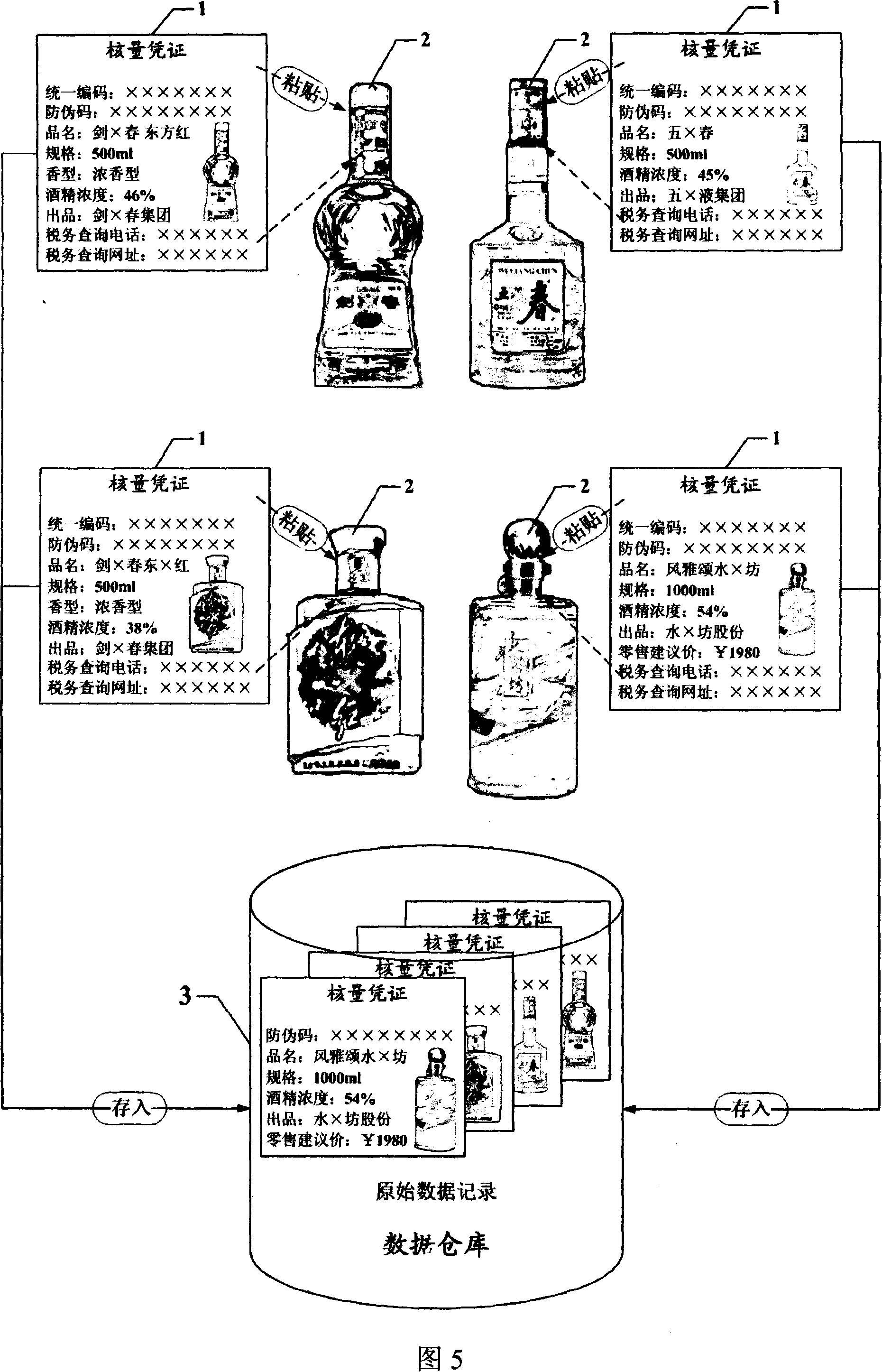

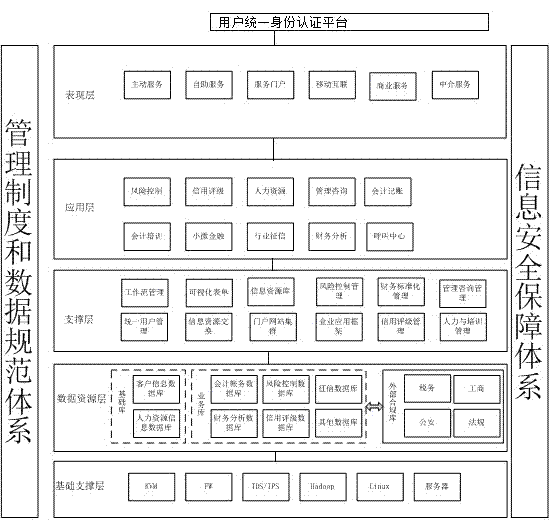

'Amount-checking invoice-control, invoice-checking tax-controlling' 'data greatly tracking' tax controlling method, system constructing and operation method

InactiveCN101136101AEasy to integrateThe implementation effect is goodFinanceFinancial managementInvoiceData acquisition

The method comprises: setting up a 'quantity-auditing' receipt on the product; a good data collecting process is added into the front end of using receipt to control the tax to audit the receipt content; the receipt electronic data is transmitted t o the tax authorities; if the number is big, the tracing the all process of good stream, draw a bill and declaring dutiable good; providing multi dimension message collection receipt.

Owner:SICHUAN ZHENGDAOTIANHE INFORMATION TECH

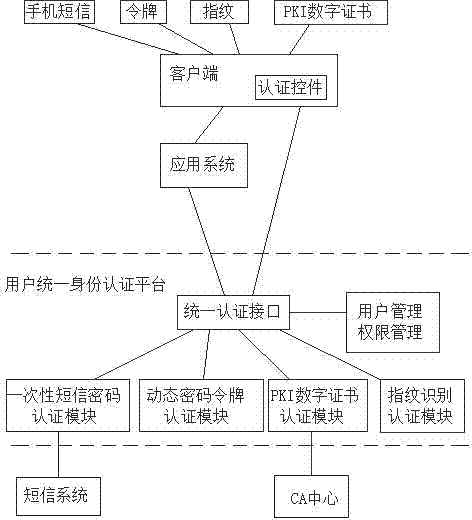

Intelligent finance and tax service platform based on SaaS platform

ActiveCN104754058AImprove work efficiencyEffectively support business activitiesFinanceUser identity/authority verificationReal-time dataWork cycle

The invention discloses an intelligent finance and tax service platform based on a SaaS platform. The intelligent finance and tax service platform comprises a basic support layer, a data resource layer, a support layer, an application layer and a presentation layer, wherein the basic support layer comprises a basic library and a service library; the support layer comprises a plurality of modules; the application layer comprises a plurality of modules; the presentation layer is a comprehensive portal unified management platform and comprises a plurality of modules. The intelligent finance and tax service platform has the advantages that the platform can provide comprehensive accounting services such as financial accounting, tax planning, tax declaration, internal audit, finance and tax consulting and headhunting, and industry development balance is promoted; by the intelligent finance and tax service platform, original accounting of enterprises is electronized, the enterprises can clearly learn about accounting progress and real-time data in an accounting work cycle, accounting efficiency is increased, and the original 8-hour accounting is changed into 24-hour accounting without location limitation.

Owner:BEICAI HEDUI NETWORK TECH NANJING CO LTD

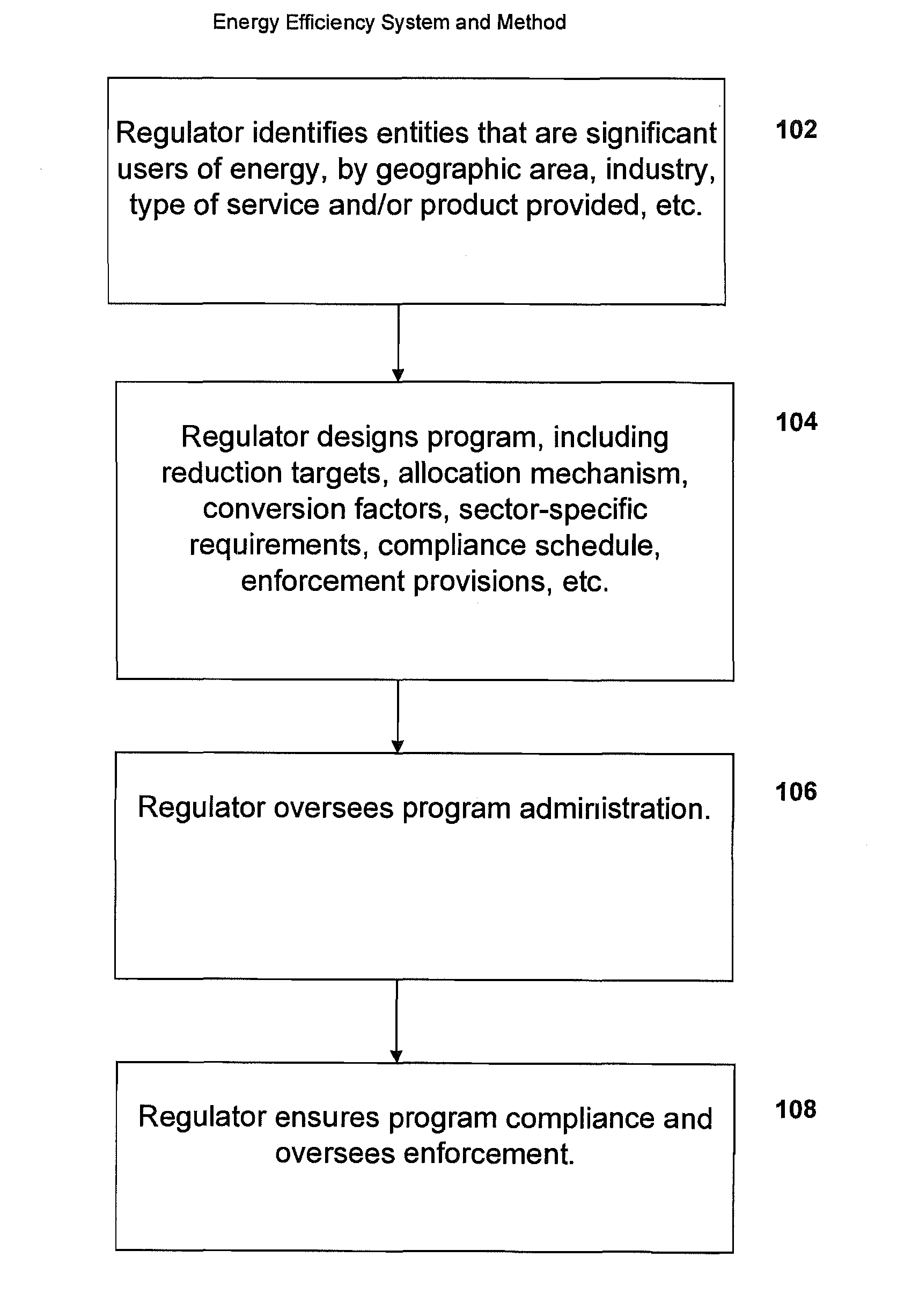

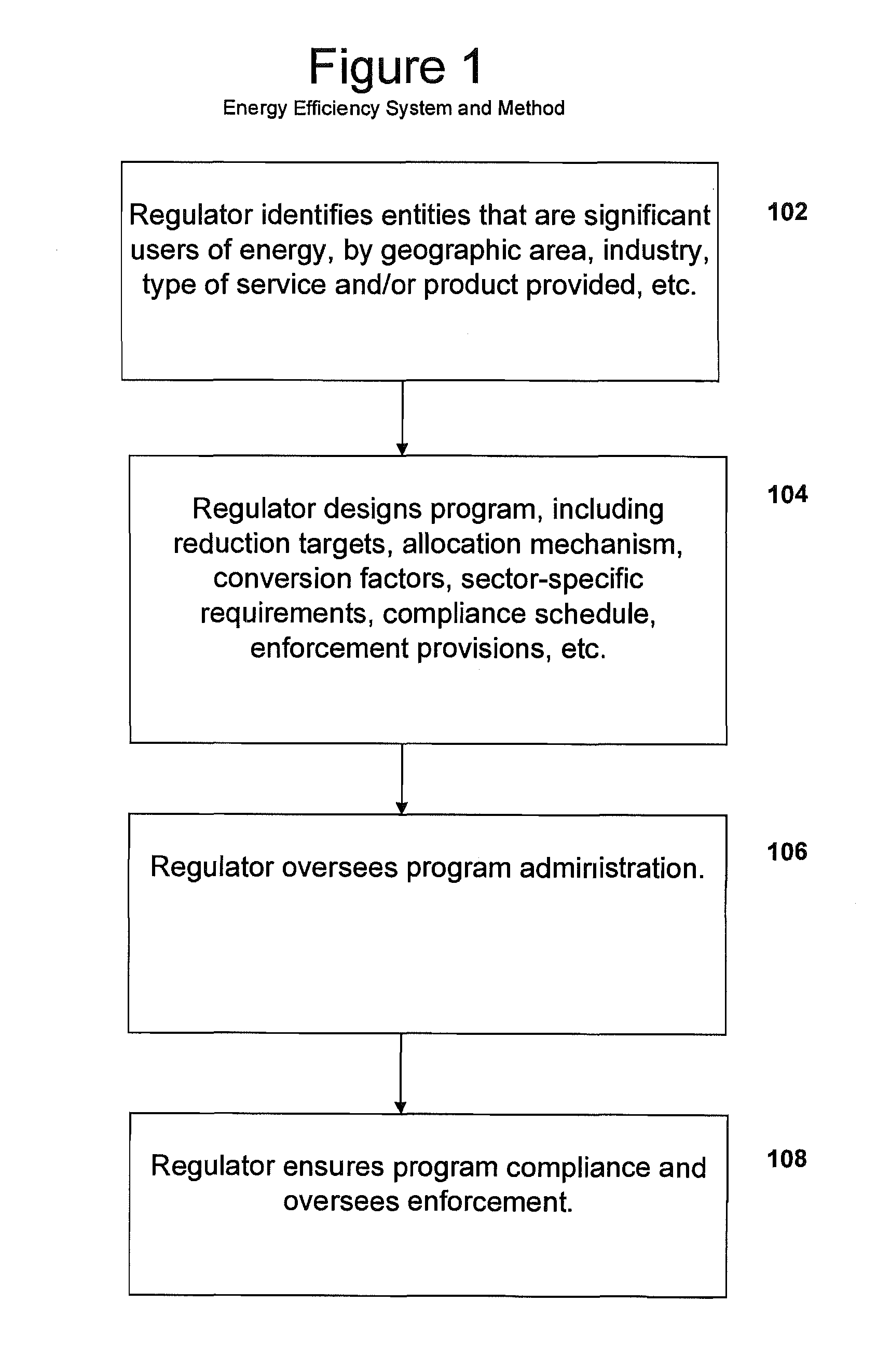

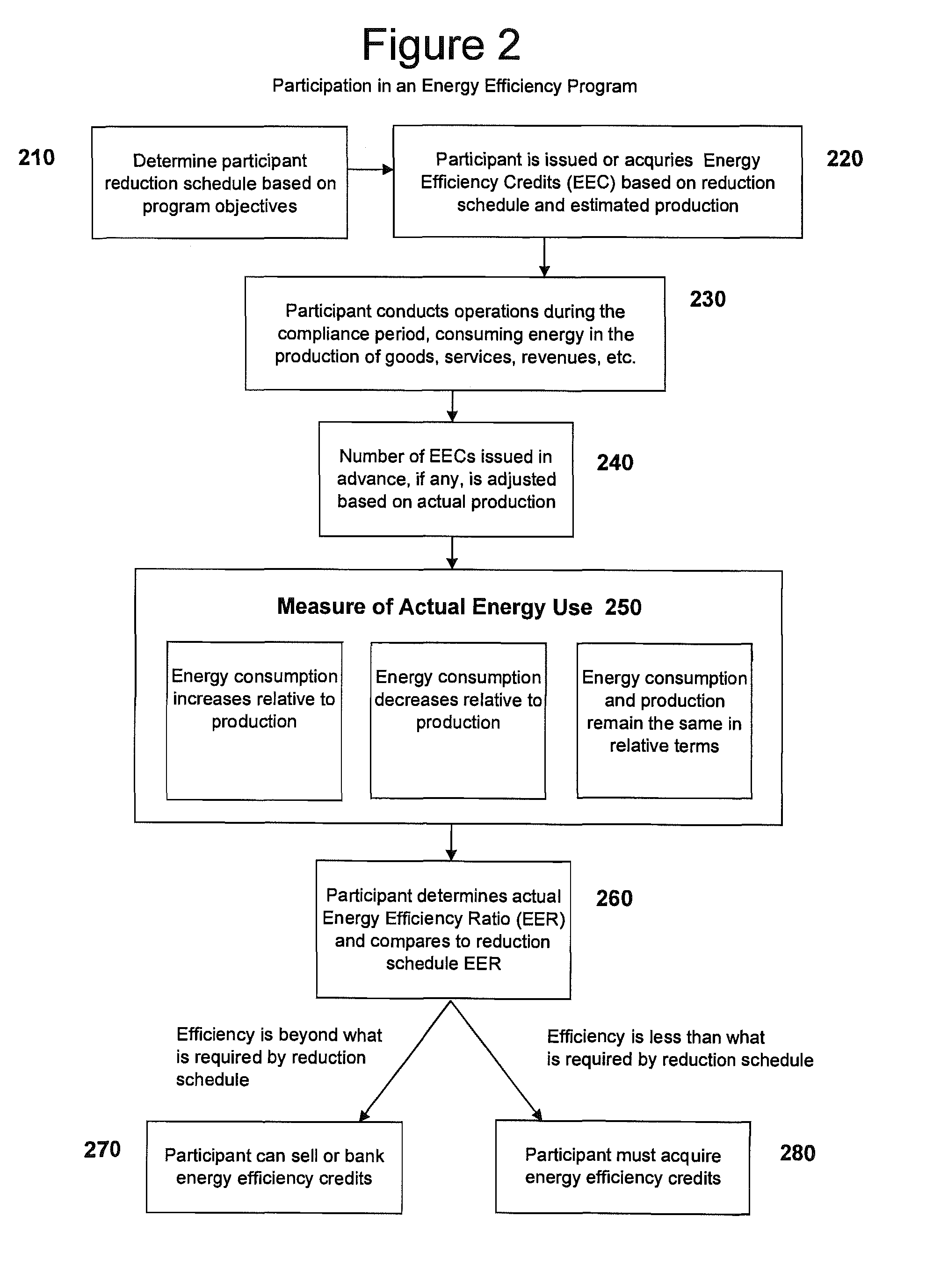

System, method, and media for trading of energy efficiency

ActiveUS20100332275A1Facilitates efficiency in tradingReduce transaction costsFinanceTechnology managementTime scheduleBusiness efficiency

A method for reducing greenhouse gas emissions by promoting more efficient energy use, by establishing a measure of efficiency, defined as a ratio of a measure of energy use to a measure of production; establishing a reduction schedule that sets limits on the energy efficiency ratio, with the schedule covering a series of compliance time periods and requiring efficient energy use during those time periods; establishing a transferable credit representing an amount of energy and establishing a tradable financial instrument representing a number of energy efficiency credits; issuing a plurality of energy efficiency credits to the entities; establishing a trading system to facilitate the sale and purchase of the financial instruments; and requiring entities to comply with the reduction schedule by making operational improvements or acquiring and surrendering credits to thus increase the efficiency of energy use in turn reducing greenhouse gas emissions.

Owner:CHICAGO CLIMATE EXCHANGE

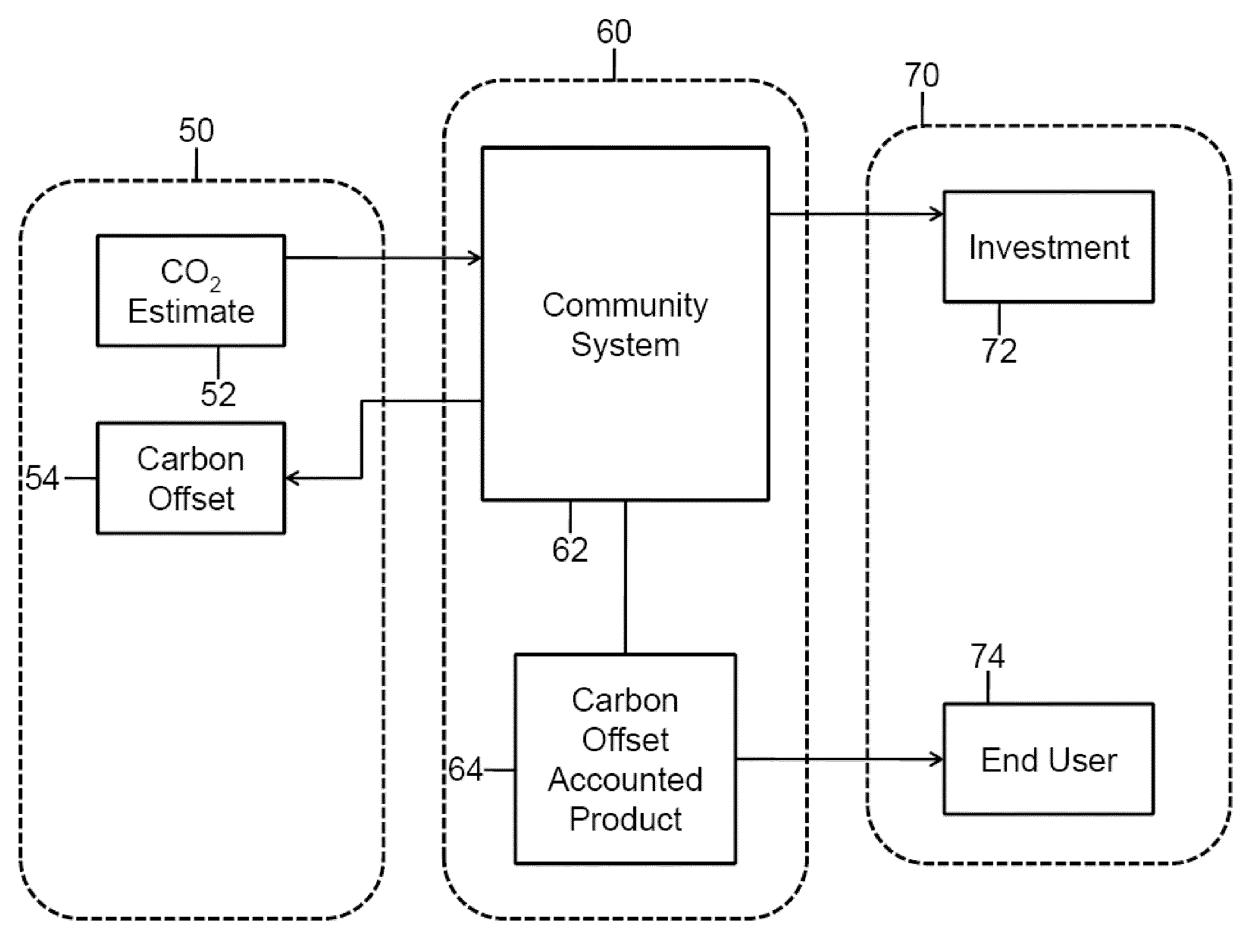

Community to address carbon offsets

InactiveUS20090319315A1MitigateLow costComplete banking machinesSustainable waste treatmentCommunity systemEngineering

A club or community of mineral producers or other interested parties is put together for the purpose of responsibility account for CO2 and / or other pollutants in produced minerals. The community utilizes a community system to track the amount of CO2 that is associated with produced minerals. The community member sponsoring the mineral contributes to the community fund an amount representative of the value of the estimated CO2 as determined by the community system. The community then utilizes the received funds to invest in carbon offset activities which in turn are returned as benefits to the community members so that either those members can sell carbon offset accounted minerals or the community can do so on the community members' behalf.

Owner:BRANSCOMB BENNETT HILL

System of systems for monitoring greenhouse gas fluxes

ActiveUS8595020B2Provide real-timeEasy to understandPigmenting treatmentSustainable waste treatmentNatural sourceGreenhouse gas flux

A system of systems to monitor data for carbon flux, for example, at scales capable of managing regional net carbon flux and pricing carbon financial instruments is disclosed. The system of systems can monitor carbon flux in forests, soils, agricultural areas, body of waters, flue gases, and the like. The system includes a means to identify and quantify sources of carbon based on simultaneous measurement of isotopologues of carbon dioxide, for example, industrial, agricultural or natural sources, offering integration of same in time and space. Carbon standards are employed at multiple scales to ensure harmonization of data and carbon financial instruments.

Owner:PLANETARY EMISSIONS MANAGEMENT

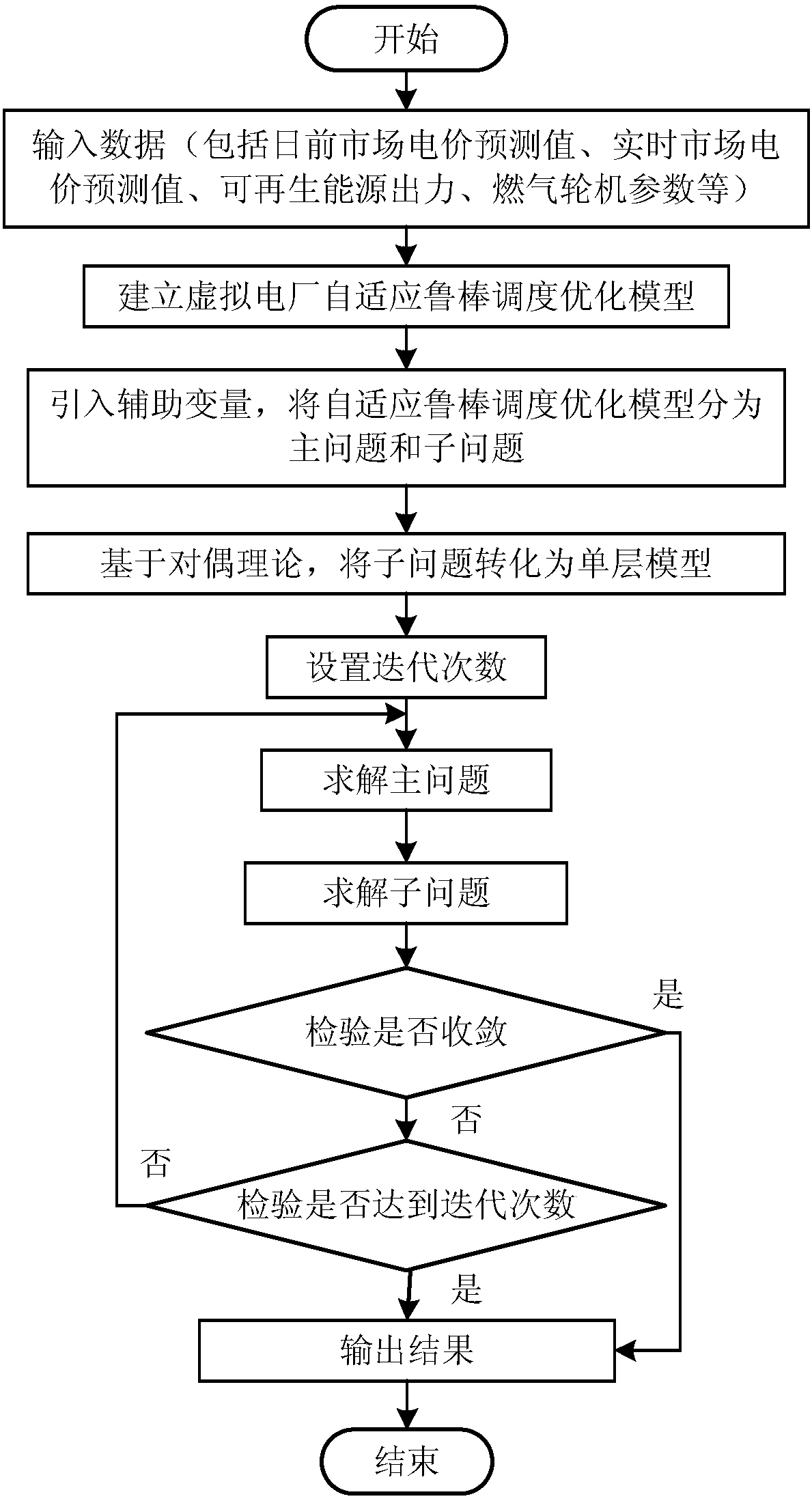

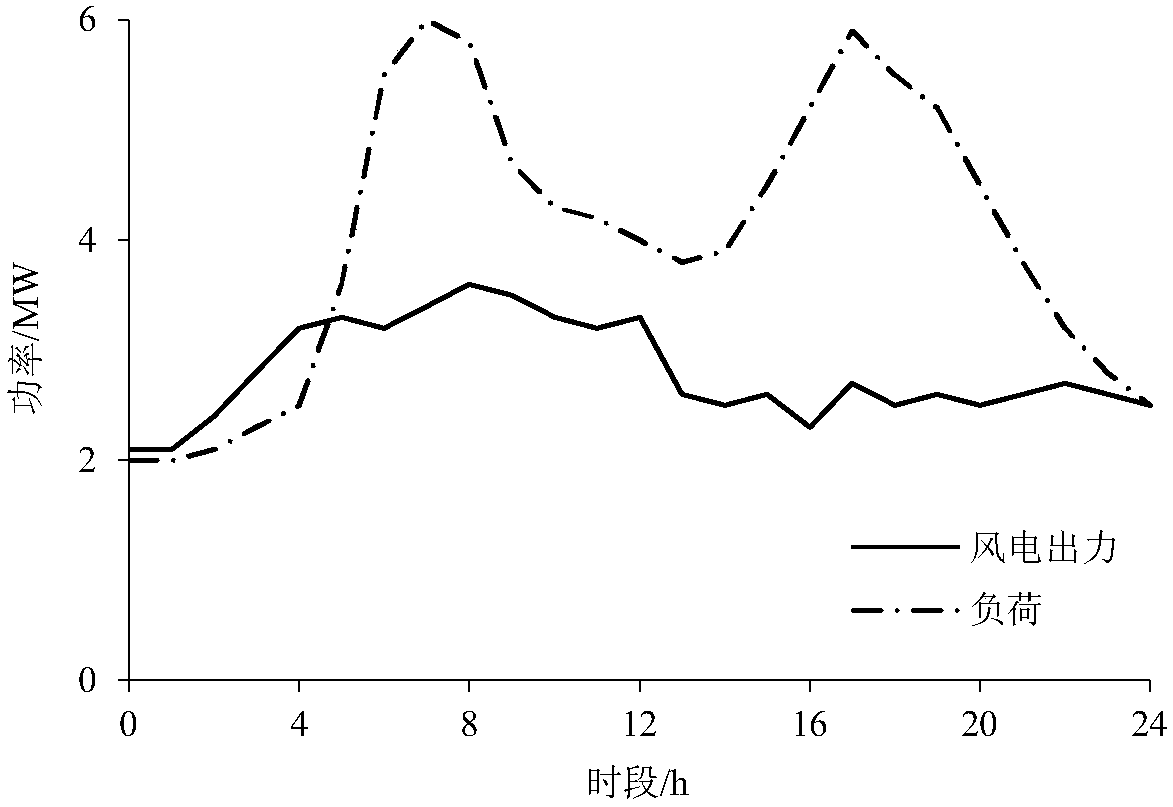

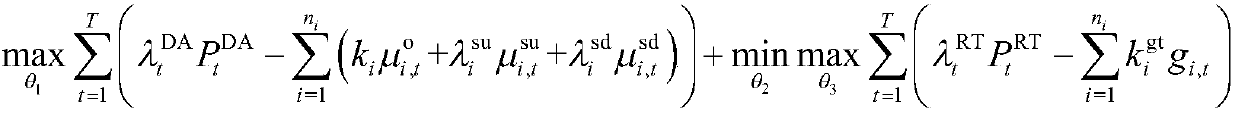

Adaptive robust scheduling optimization method for virtual power plant

ActiveCN108388973AReduce riskIncrease incomeFinancial managementResourcesEconomic benefitsVirtual power plant

The invention discloses an adaptive robust scheduling optimization method for a virtual power plant. The method adopts adaptive robust scheduling optimization to process the output uncertainty of renewable energy sources, and considers the day-ahead and real-time two-stage scheduling of the virtual power plant. A model established with the adaptive robust scheduling optimization method is a three-layer optimization model. In order to solve the problem, the method comprises the following steps that: firstly, importing an auxiliary variable, dividing the model into a single-layer main problem and double-layer sub problems; secondly, through a duality theory, converting the double-layer sub problems into the single-layer problem; and finally, adopting a column sum constraint generation method, and solving the main problem and the sub problems through alternating iteration until the gap of two problems is converged into an acceptable range. Compared with statistic robust optimization, themethod is characterized in that the balance situation of the regulation strategy and the real-time market of each polymerization unit in the virtual power plant after the output of the renewable energy sources is obtained is considered, the fluctuation of renewable energy sources can be effectively stabilized, and the economic benefit of the virtual power plant is improved.

Owner:HOHAI UNIV

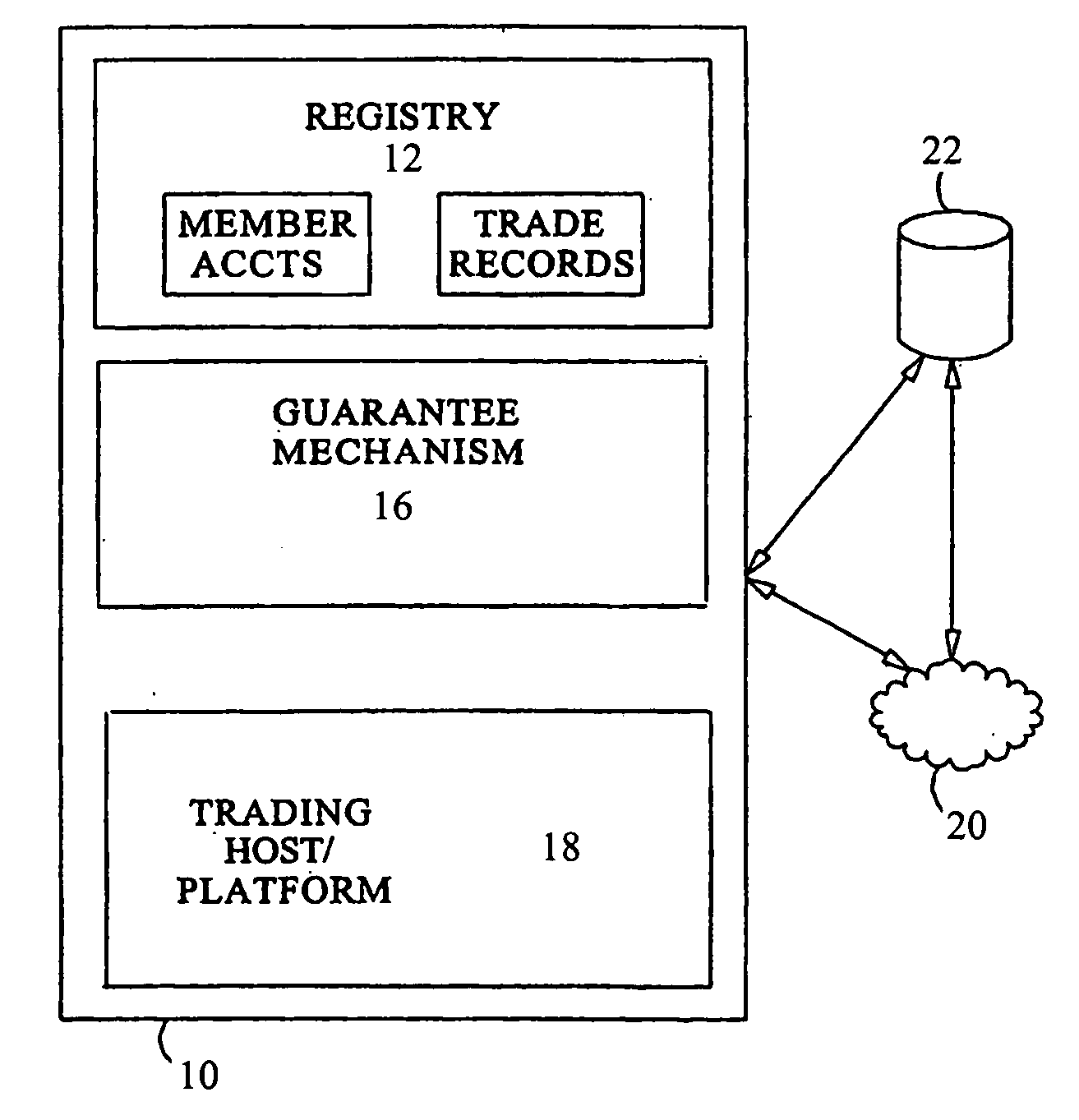

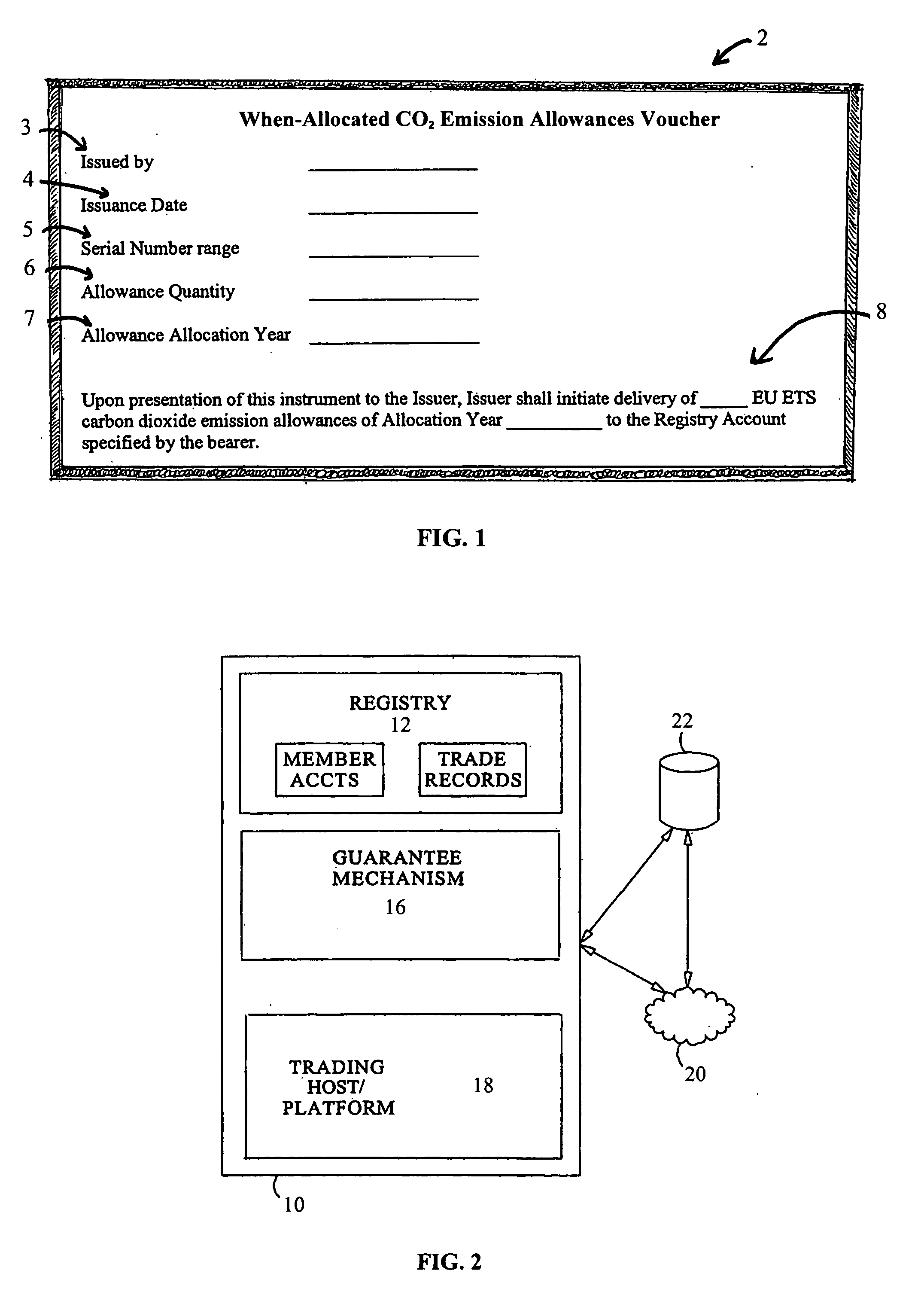

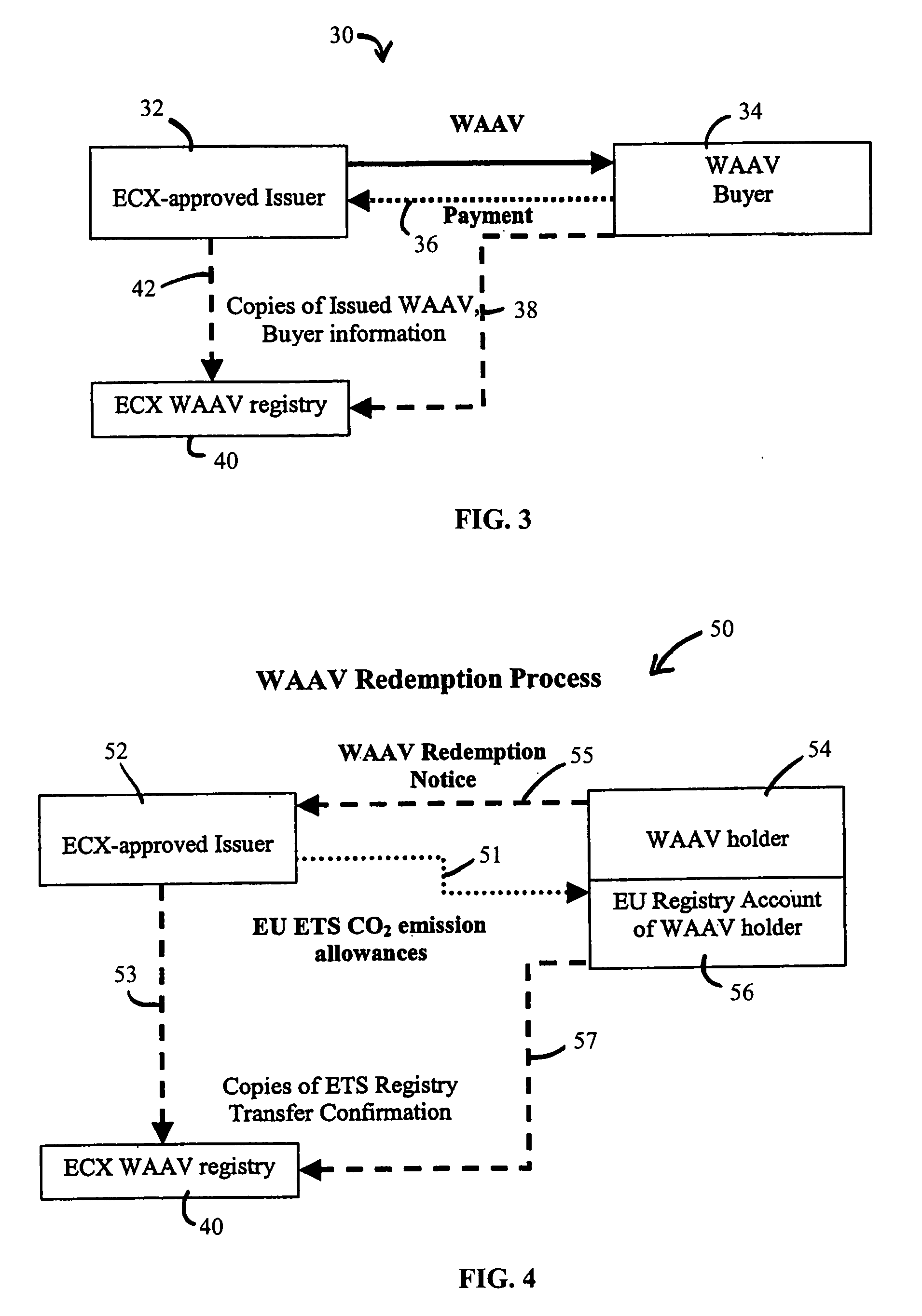

Method for facilitating the sale of a commodity

A method for facilitating the future sale of a commodity is described. The technique includes creating a tradable when-allocated allowance voucher, and selling the voucher at a set present price to a buyer who desires to acquire the amounts of the commodity at the future date. The voucher represents allocated allowance amounts of a commodity that is expected to be available at a future date.

Owner:CHICAGO CLIMATE EXCHANGE

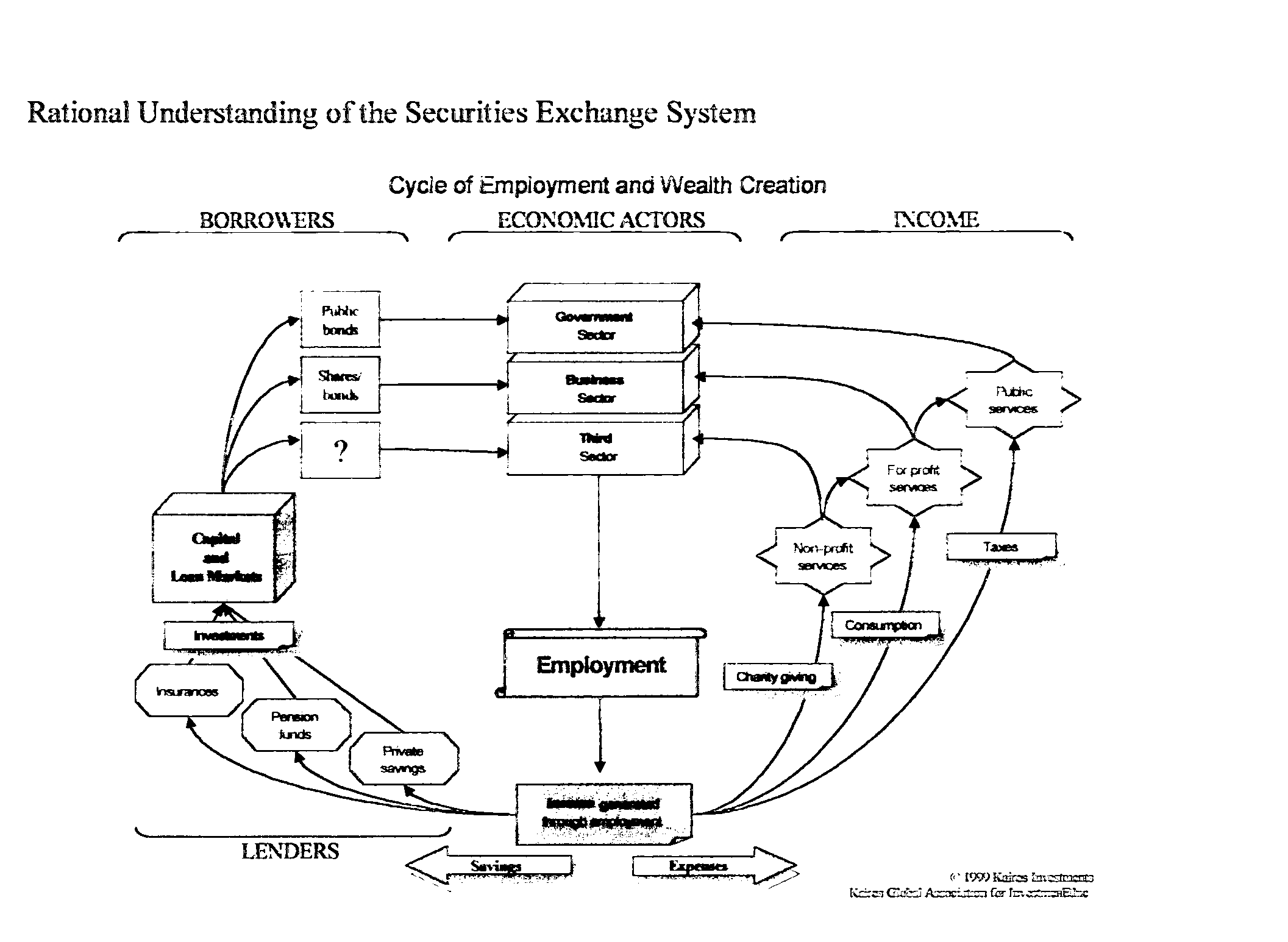

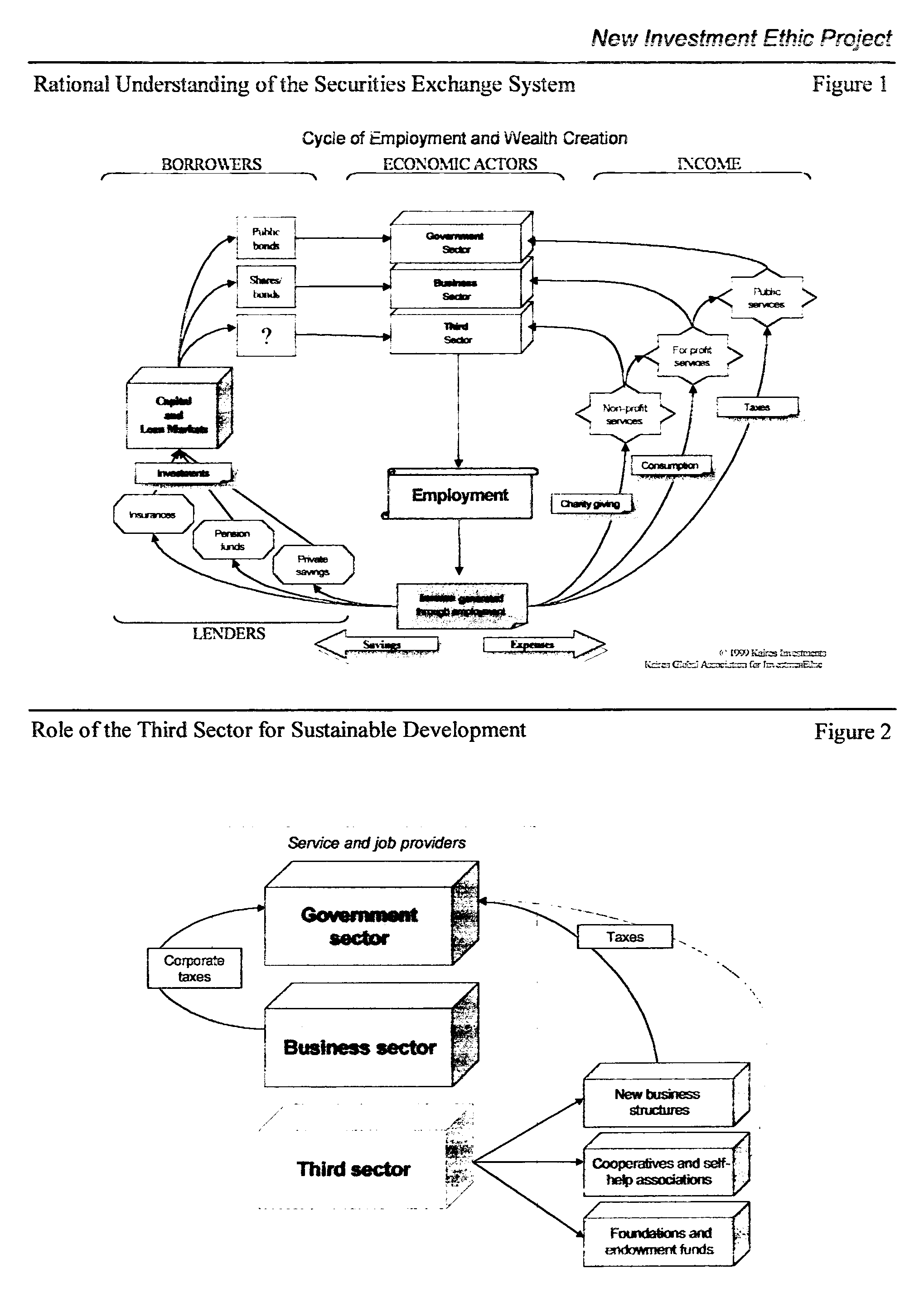

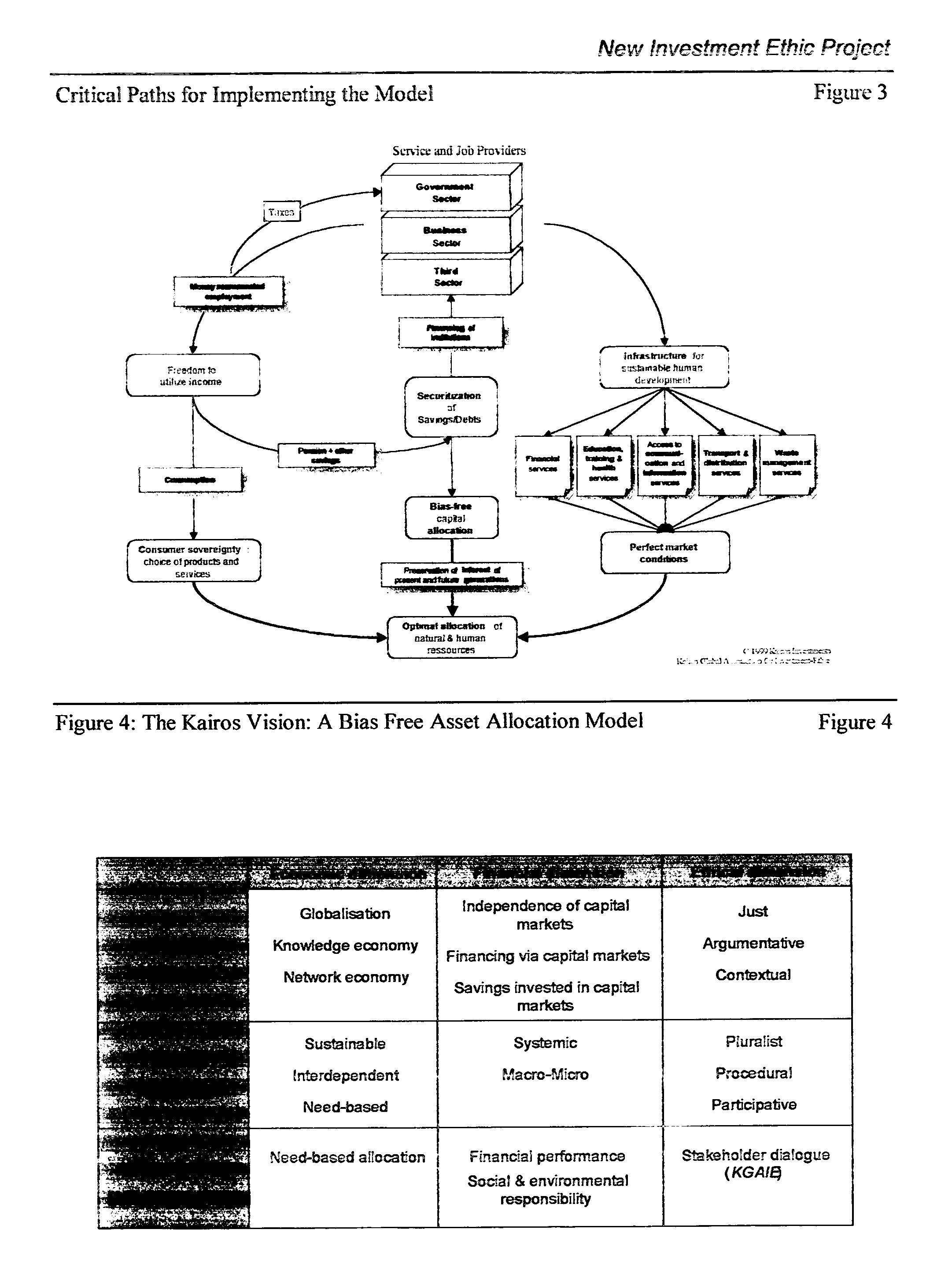

Ethically coherent and scientifically logical method for allocating assets in portfolios of investments

InactiveUS20070130060A1Reduce tensionAlleviating critical tensionFinanceFinancial managementNatural resourceKnowledge management

The present invention concerns the technical aspects of applying ethics to the field of investment industry. It provides an ethically coherent and scientifically logical Method for allocating assets in portfolios of investments and a model Fund product that applies this Method to detract systemic tensions that generate frequent crisis of the financial markets in monetized economies. This is a novel mechanism to provide equality in access to both information and credit and thereby contributes to: a stable increase in financial return on investments; an optimal allocation of human resources through the creation of employment in both hard and soft currency countries, and an environmentally optimal depletion of natural resources through the development of democratic model of service economies in a continuous process. The implementation of the project is assisted by a computer program and a data base product, and monitored through an ethically coherent business organization method.

Owner:KAIROS INVESTMENTS

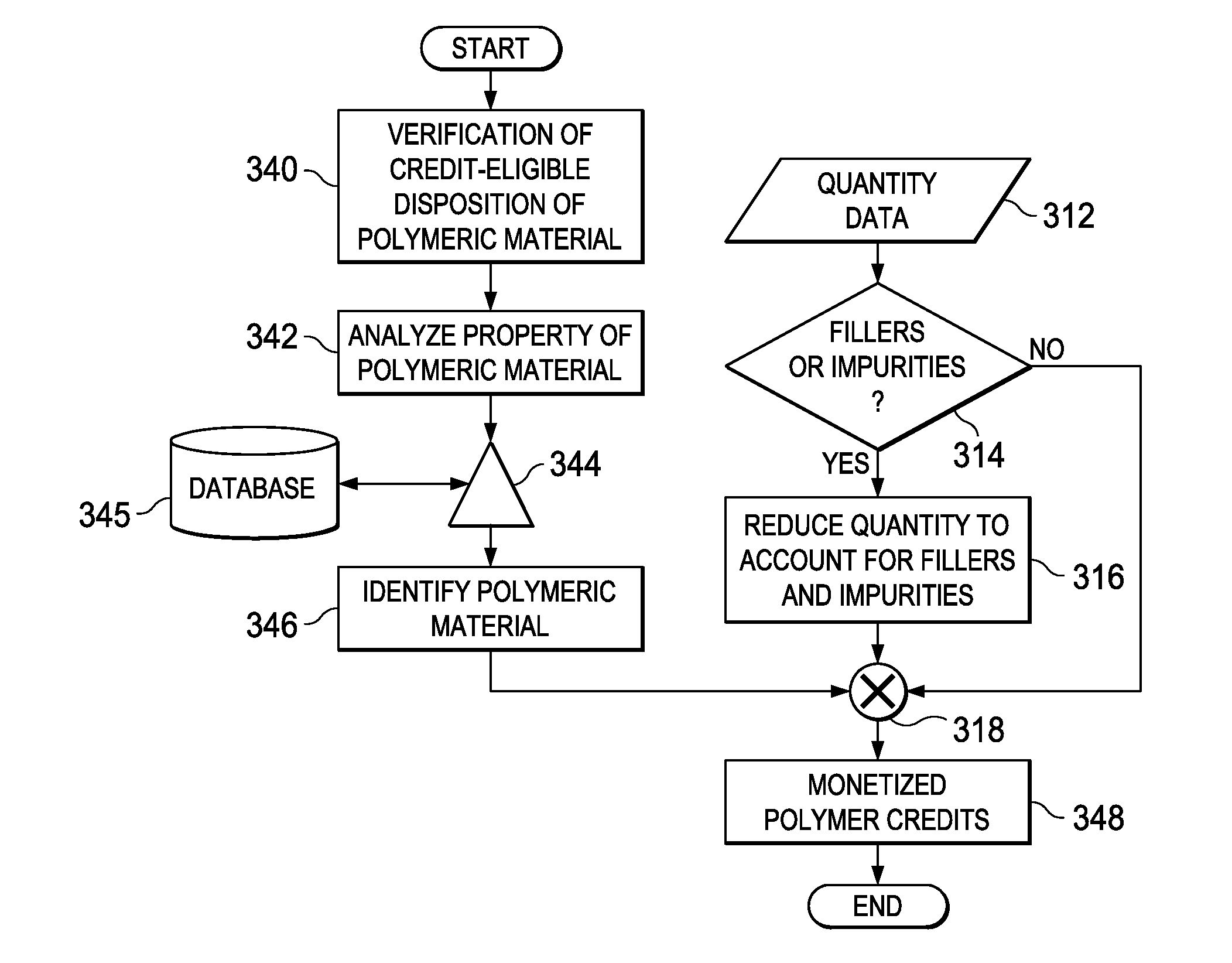

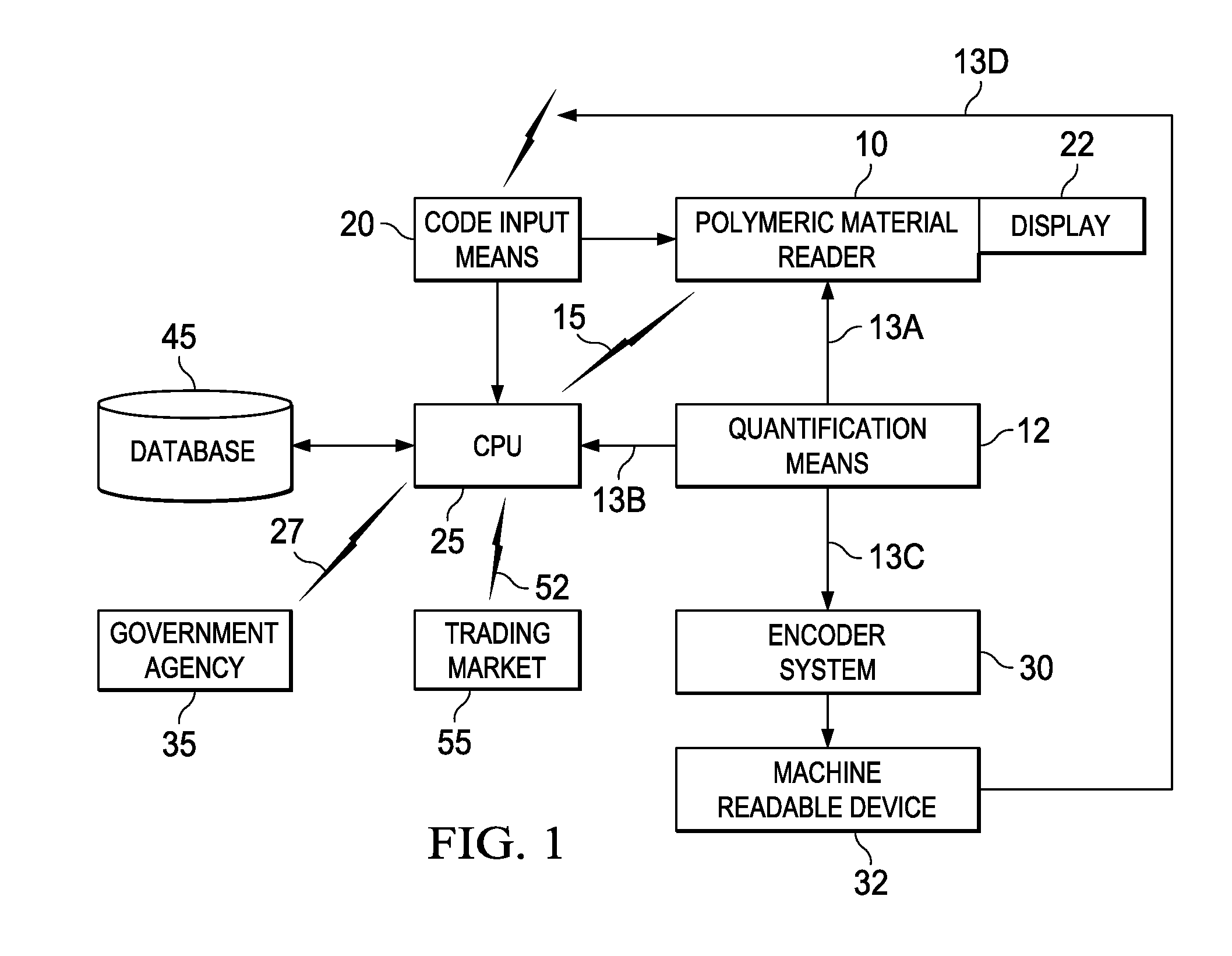

System and method for monetizing and trading energy or environmental credits from polymeric materials

The present invention is a system and method for monetizing and trading value in polymeric materials, forming polymer energy credits and / or polymer environmental credits. The system promotes the highest and best use and disposition of polymer waste, scraps and used material. The new types of credits have a value which can be bought, sold and traded in a market exchange. A polymer manufacturer can assign predetermined credit value to polymeric material sent into commerce which can be realized upon disposition of polymeric material in a predetermined or prescribed manner and credited to the manufacturer and / or user of the polymeric material. Alternatively, a verification authority may be implemented to review claims of entitlement to credits and may take into account factors relevant to the polymeric material to assign value to verified polymer energy or environmental credits and / or to certify various entities engaged in the process.

Owner:EMPIRE TECH DEV LLC

Popular searches

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com