Patents

Literature

175results about How to "Simplify creation" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

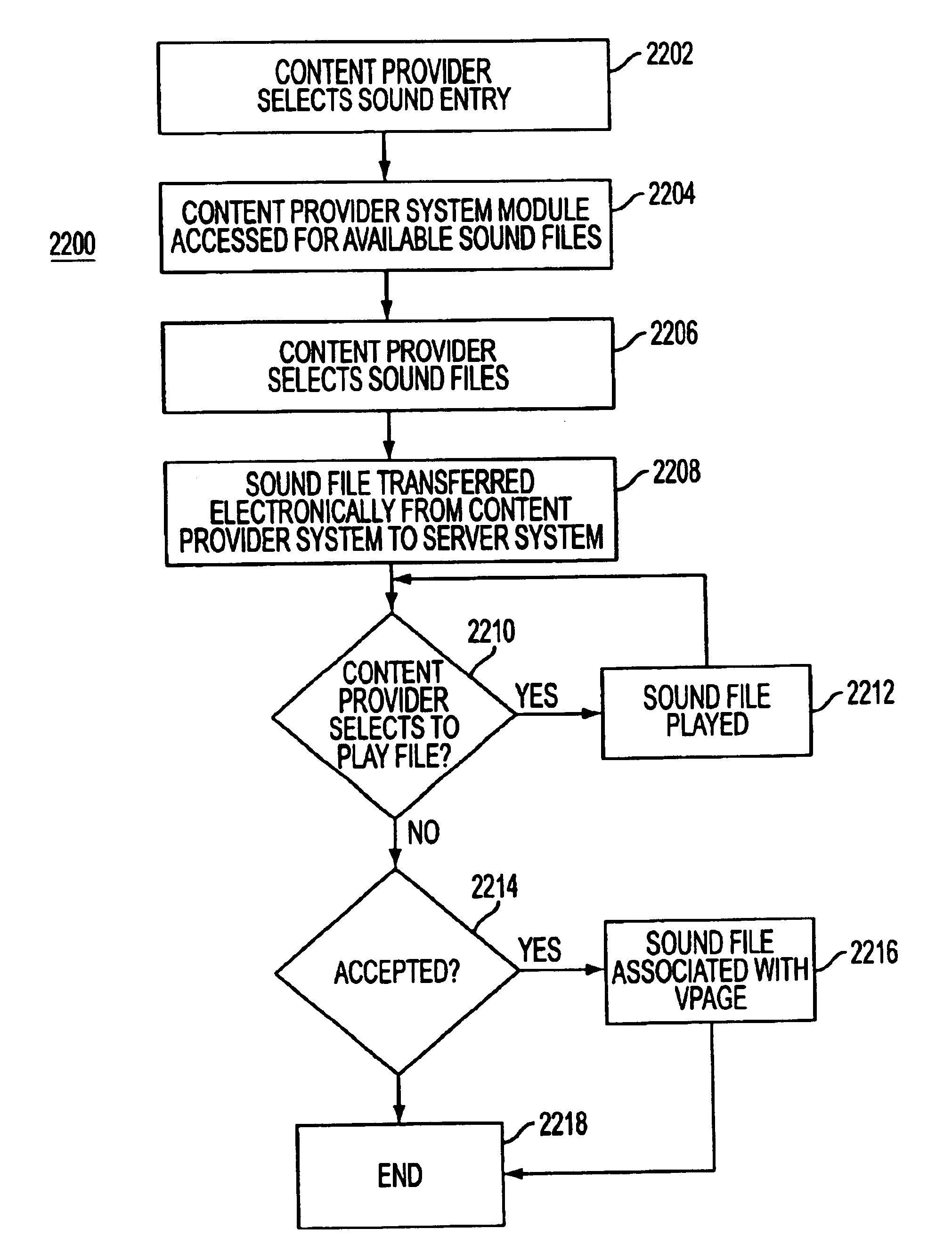

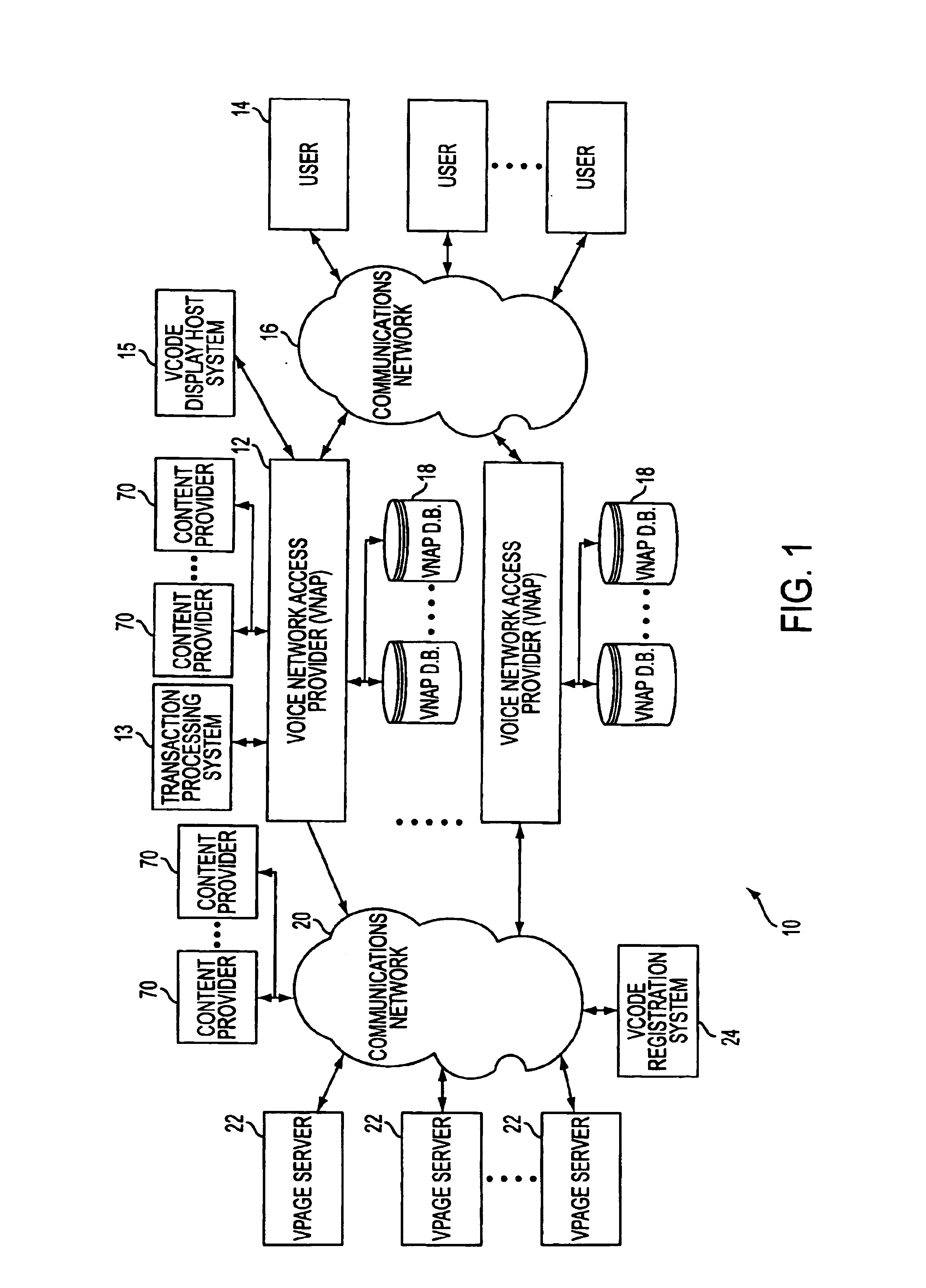

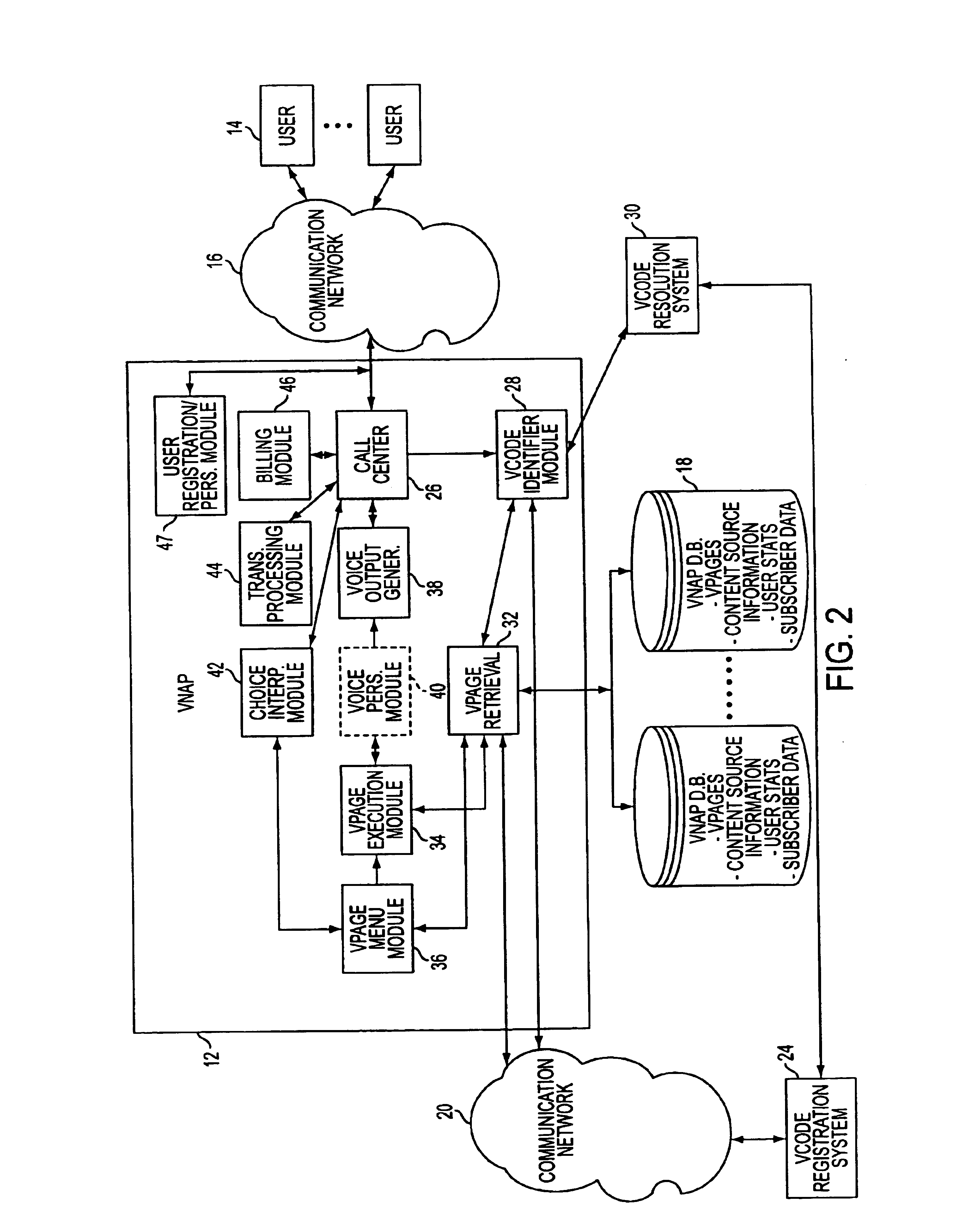

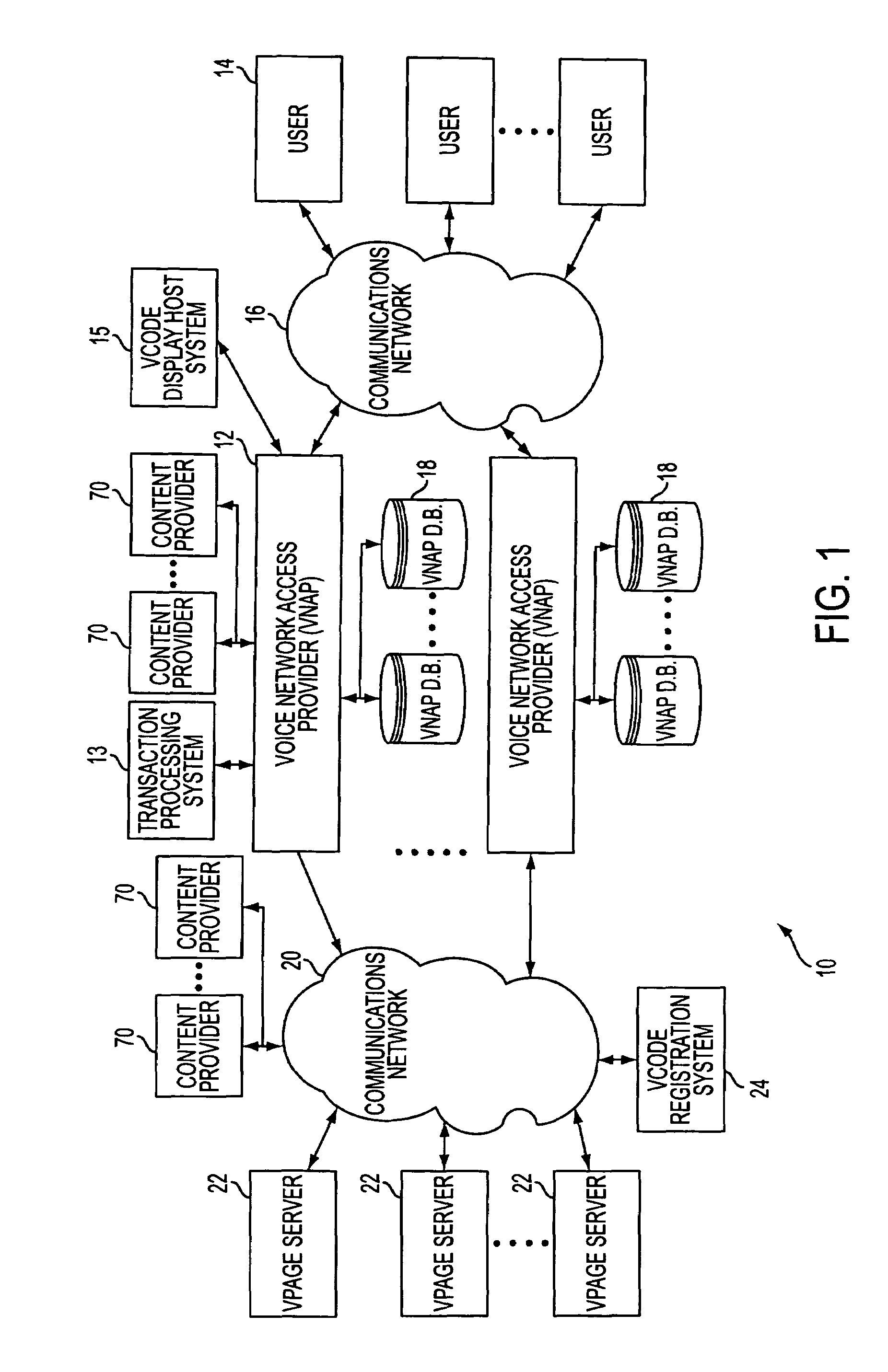

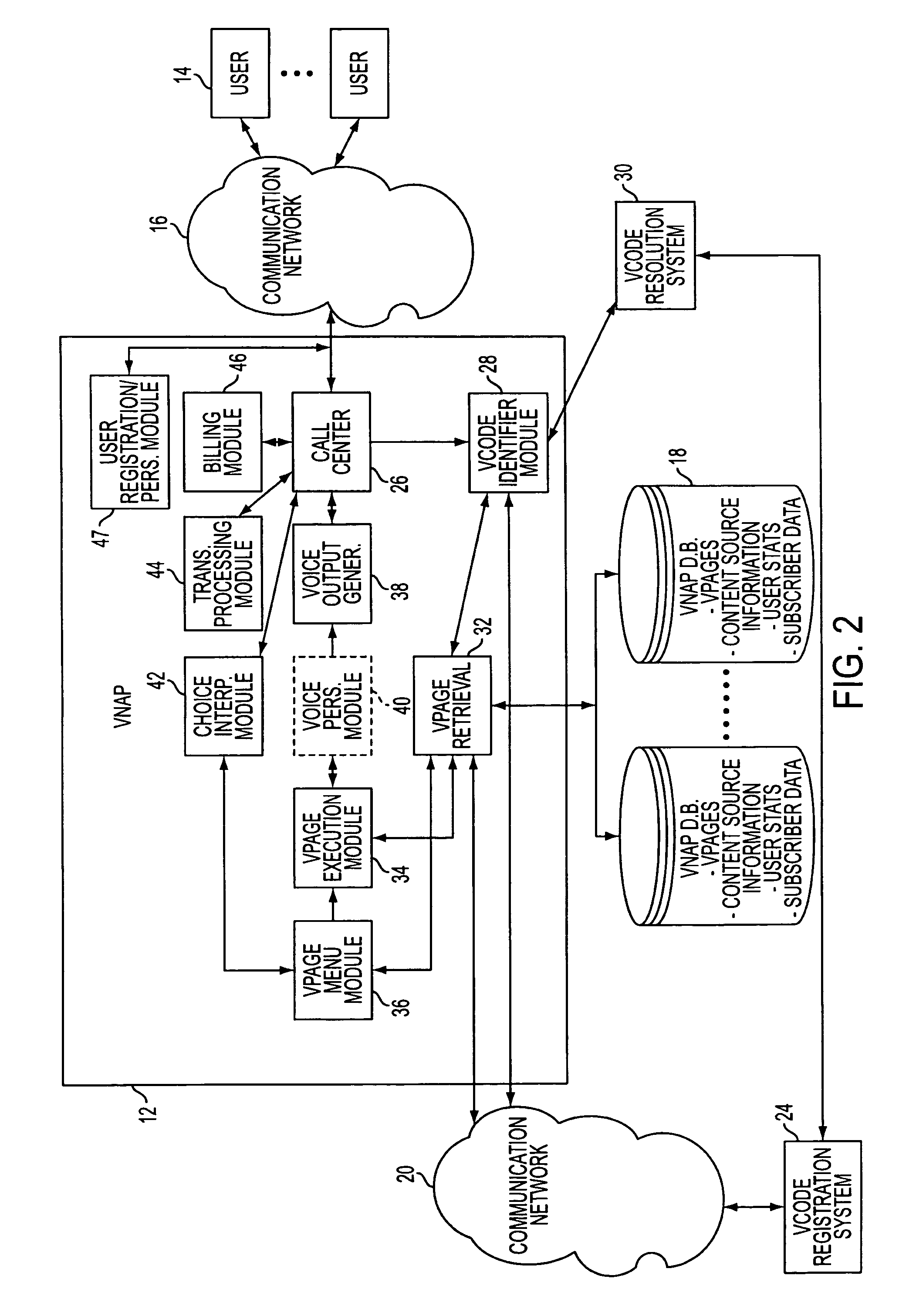

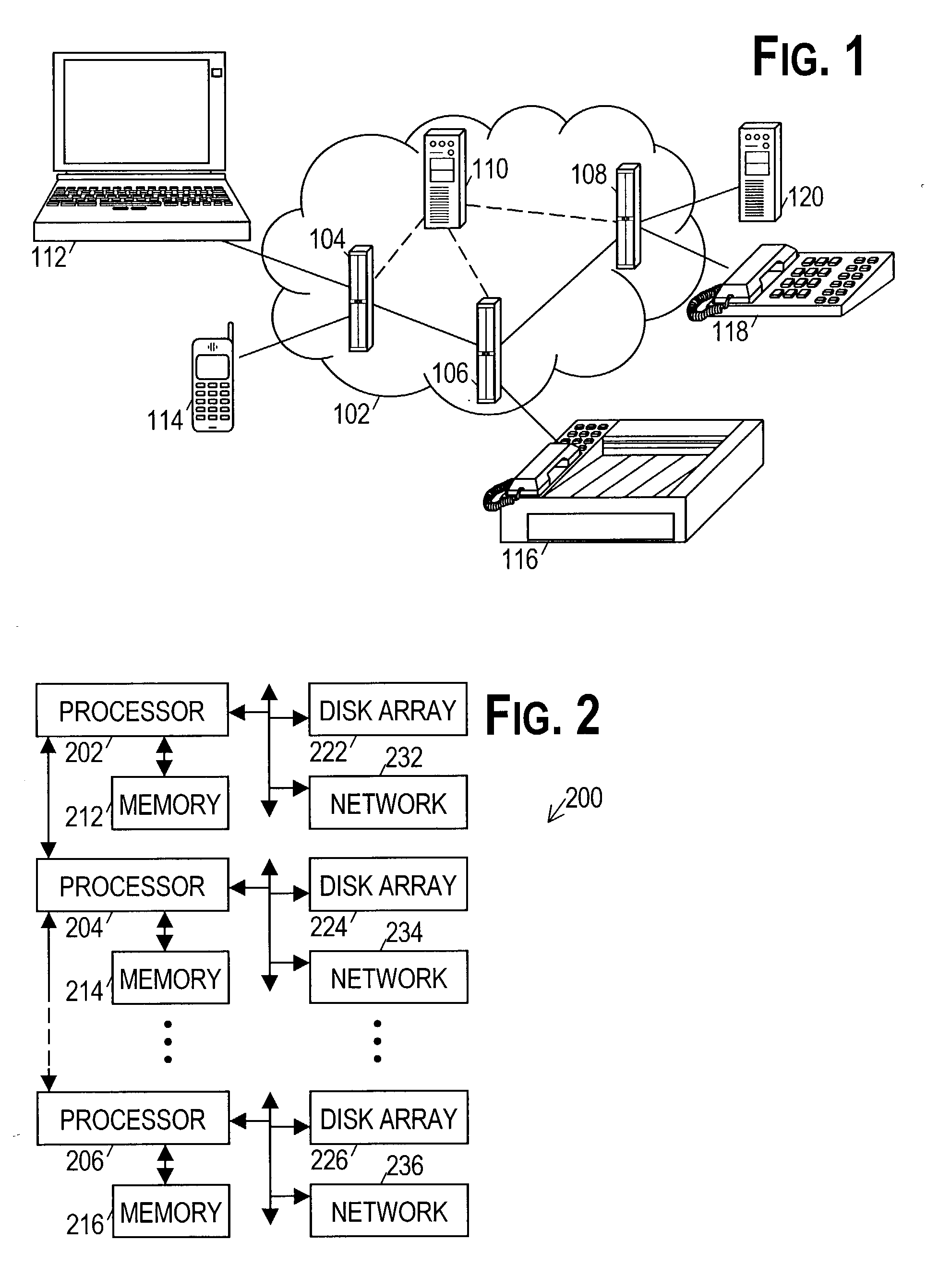

System and method for generating voice pages with included audio files for use in a voice page delivery system

InactiveUS6895084B1Require lotSimplify creationAutomatic call-answering/message-recording/conversation-recordingRecord information storageUser deviceSpeech sound

A content provider system for enabling content providers to create voice pages with audio files included for use in a network for voice page delivery through which subscribers request a voice page and a voice page server system delivers the voice page audibly to the subscriber. A content provider selects a voice page into which the audio file is to be incorporated, selects the audio file and the content provider system then transfers the audio file to a voice page server system which generates a voice page with the audio file included using XML-based tags designated for audio files. The audio files are uploaded from a number of user devices including a telephony device, a web-based system and a PDA.

Owner:GENESYS TELECOMMUNICATIONS LABORATORIES INC

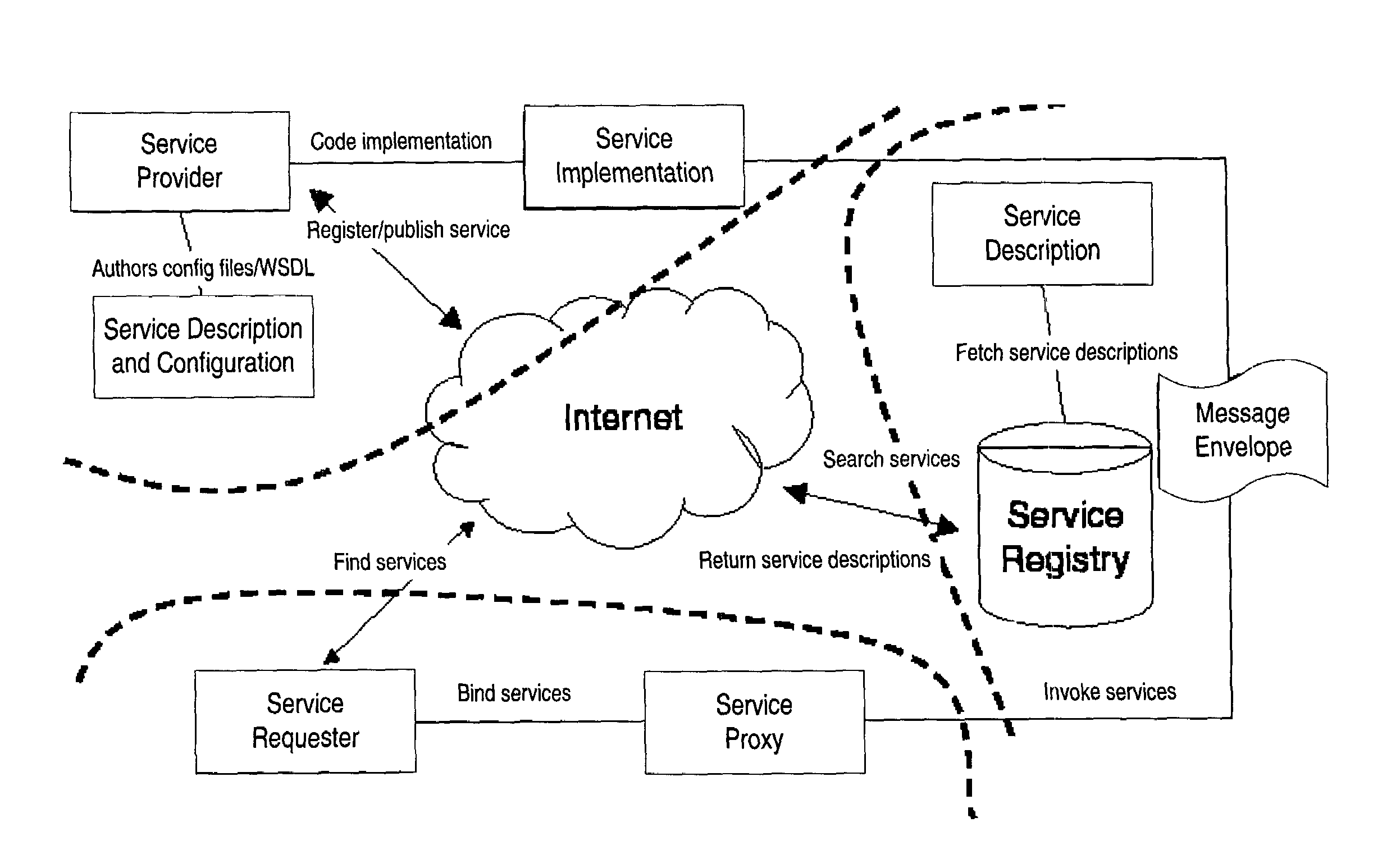

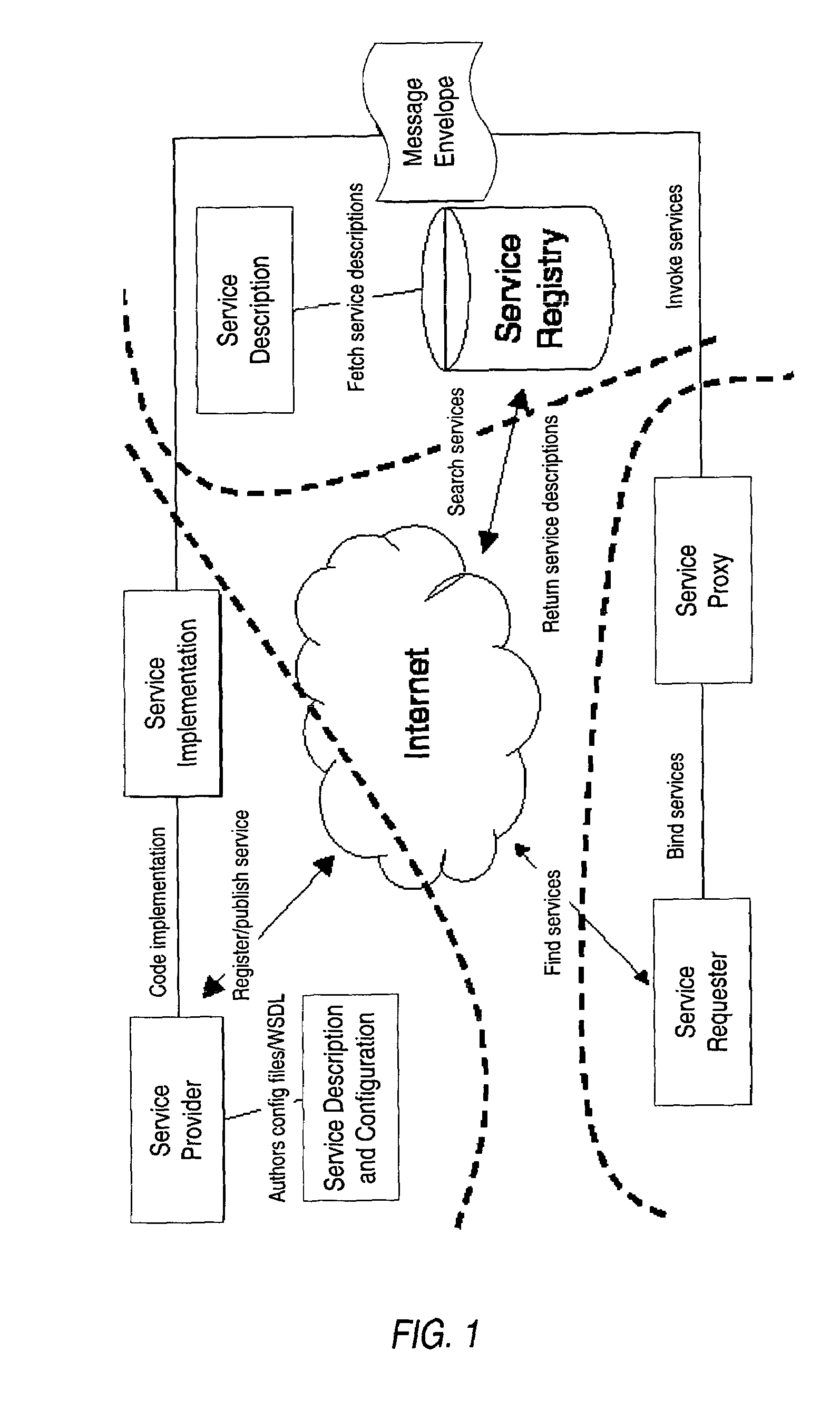

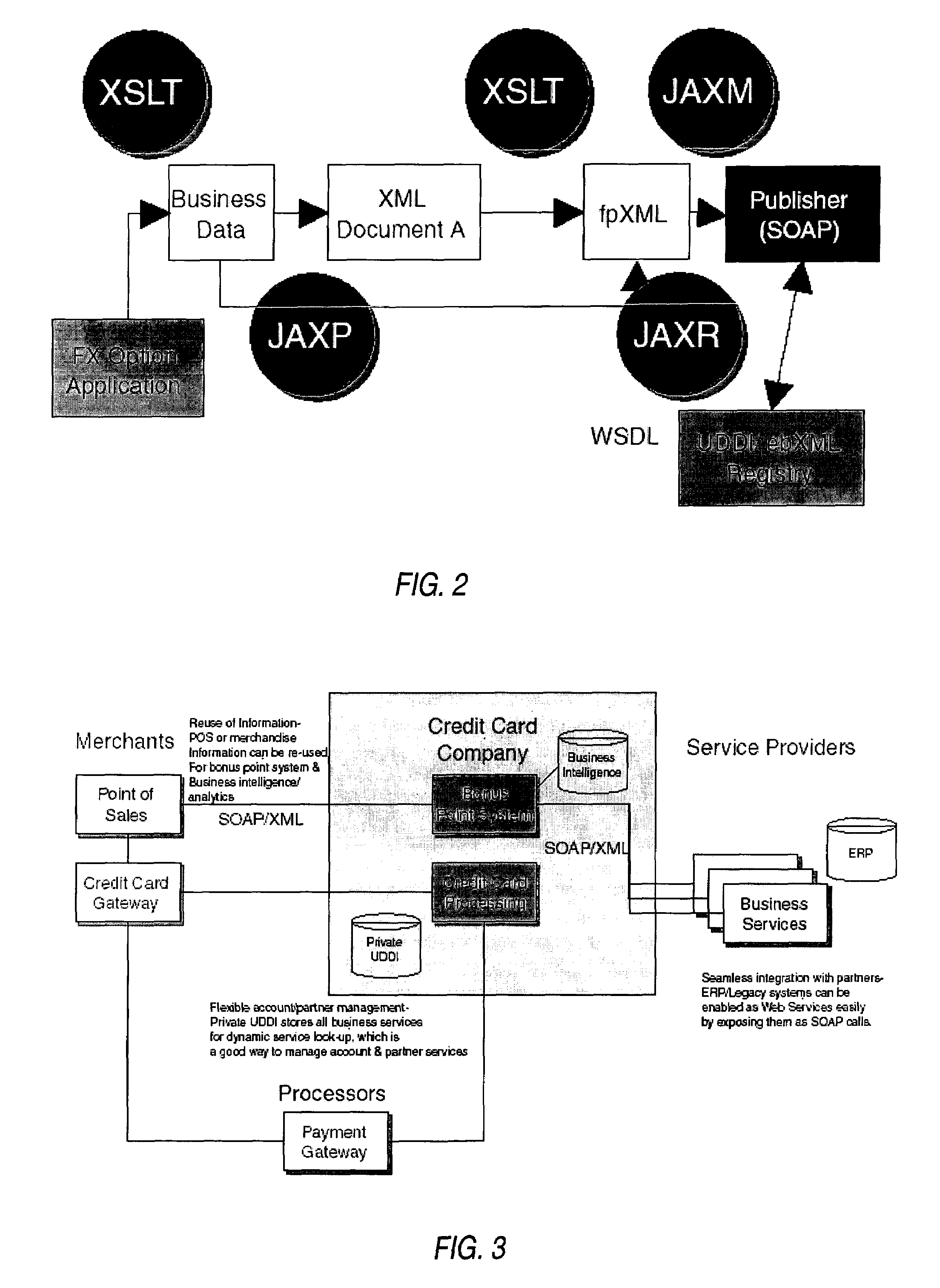

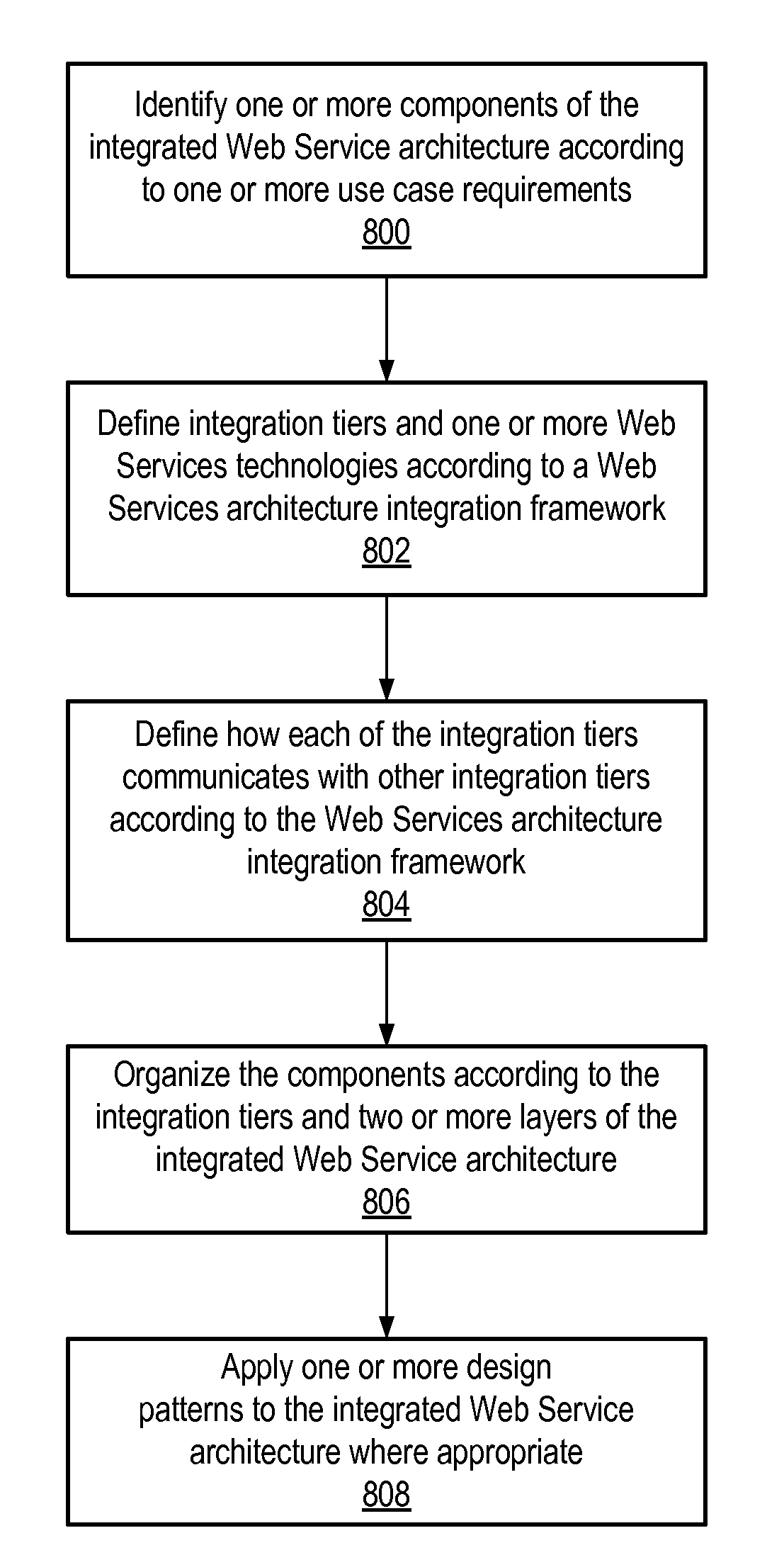

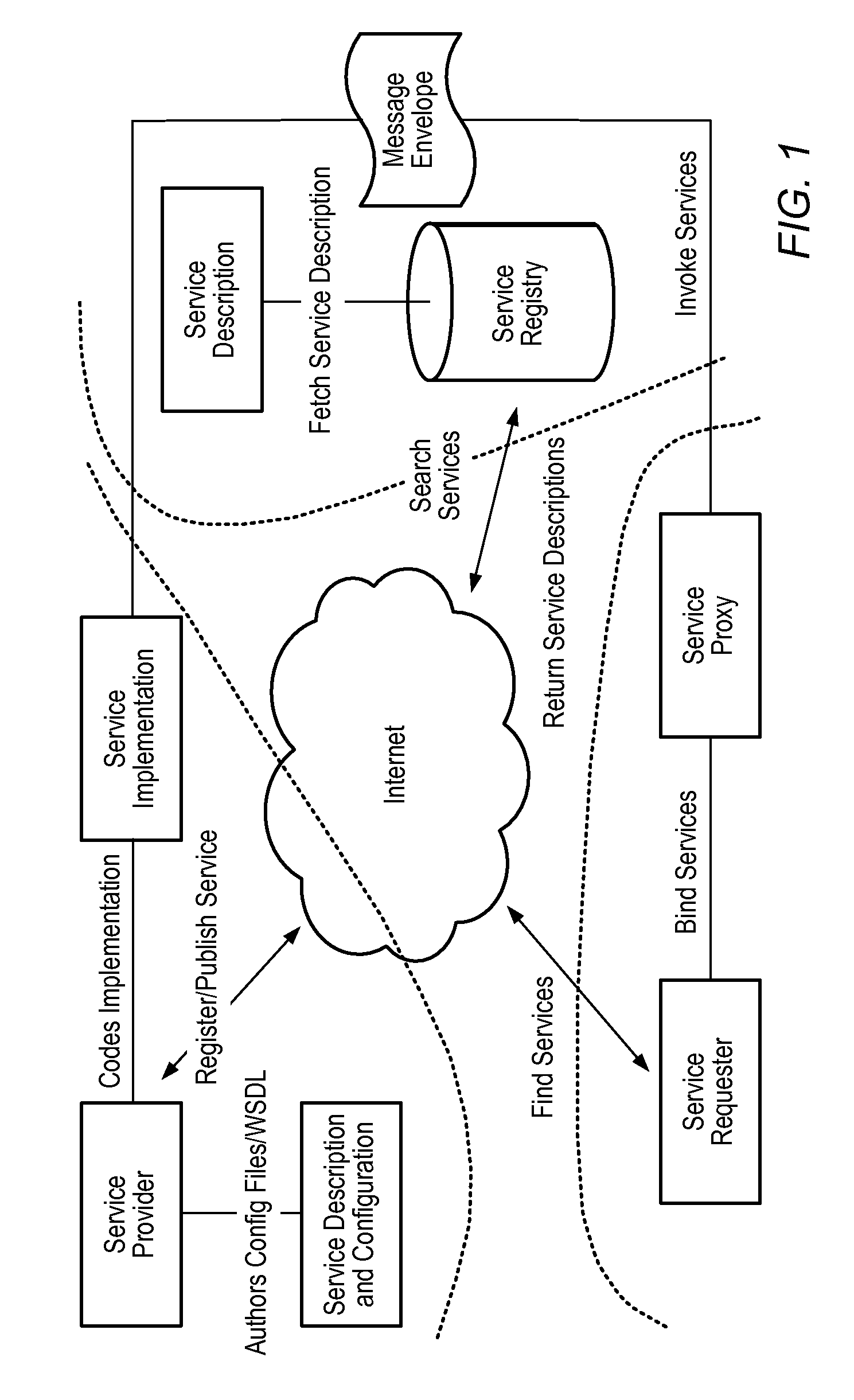

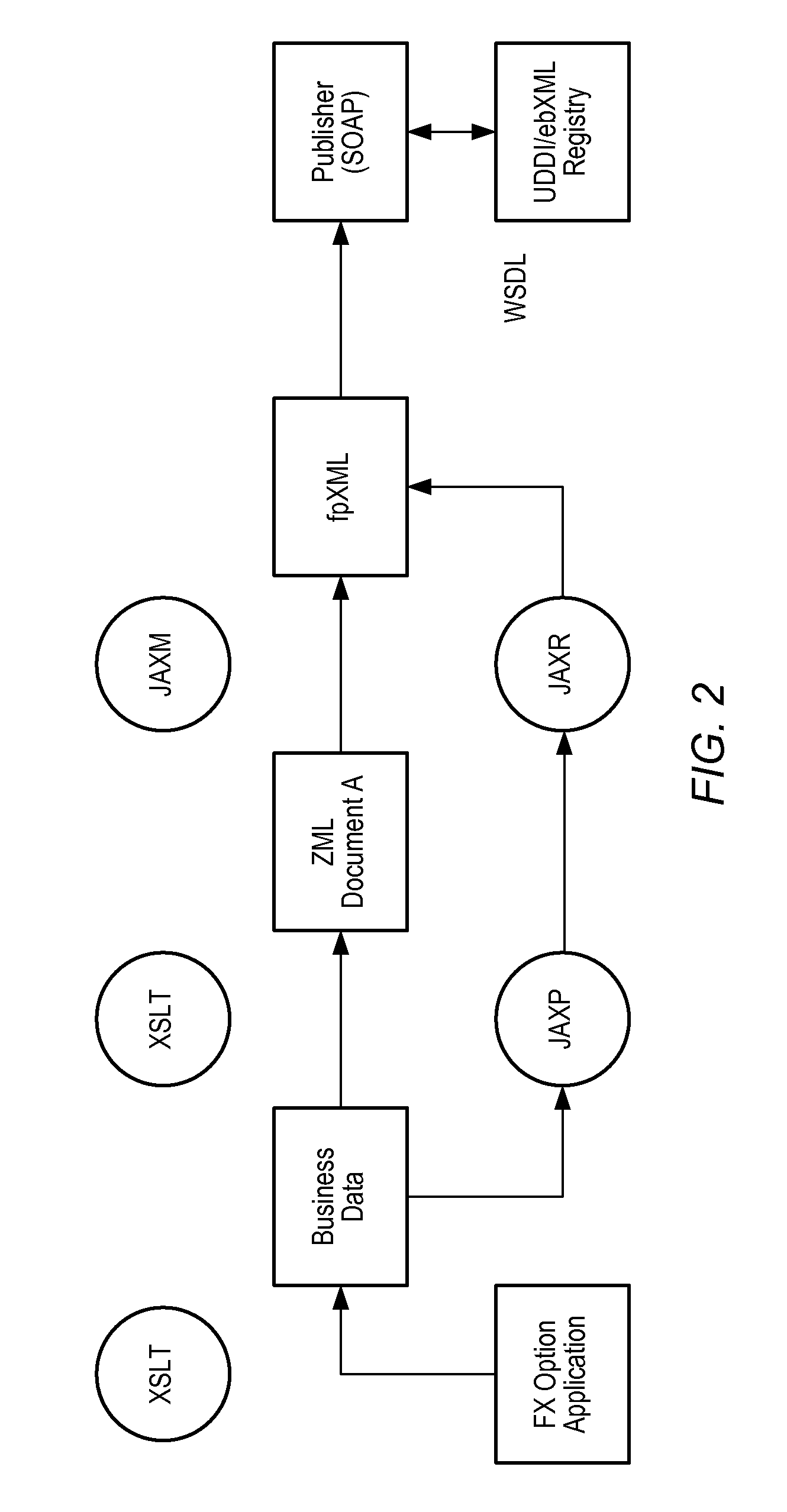

System and method for generating Web Service architectures using a Web Services structured methodology

ActiveUS7698398B1SOAP messaging reliableReduce effortMultiple digital computer combinationsOffice automationEnterprise integrationDesign pattern

System and method for generating Web Services using a Web Services Structured Methodology. One embodiment may be implemented as a Web Services architecture design mechanism. Lifecycles of the Web Services design process may include vision and strategy, architecture design, development, integration, and deployment. In one embodiment, the Web Services architecture design mechanism may implement a structured methodology design process for Web Services. One embodiment may include a reusable Web Services design pattern catalog and a mechanism for maintaining and updating the catalog and for using the catalog to apply design patterns when designing and implementing Web Services. One embodiment may be used for Enterprise And Cross-Enterprise Integration of Web Services. One embodiment may be used for Legacy Mainframe Integration and Interoperability with Web Services.

Owner:ORACLE INT CORP

System and method for integration of web services

ActiveUS8069435B1SOAP messaging reliableReduce effortOffice automationBuying/selling/leasing transactionsLegacy systemEnterprise integration

System and method for integrating Web Services using a Web Services Structured Methodology are described. Embodiments of a Web Services Structured Methodology may be used to integrate Web Services in Enterprise and Cross-Enterprise business systems, and to integrate legacy systems (e.g. legacy mainframe systems) with Web Services in Enterprise and Cross-Enterprise business systems. Embodiments may provide an integrated Web Services architecture design mechanism that may be used for Enterprise and Cross-Enterprise integration of Web Services. Embodiments may be used for Legacy Mainframe Integration and Interoperability with Web Services.

Owner:ORACLE INT CORP

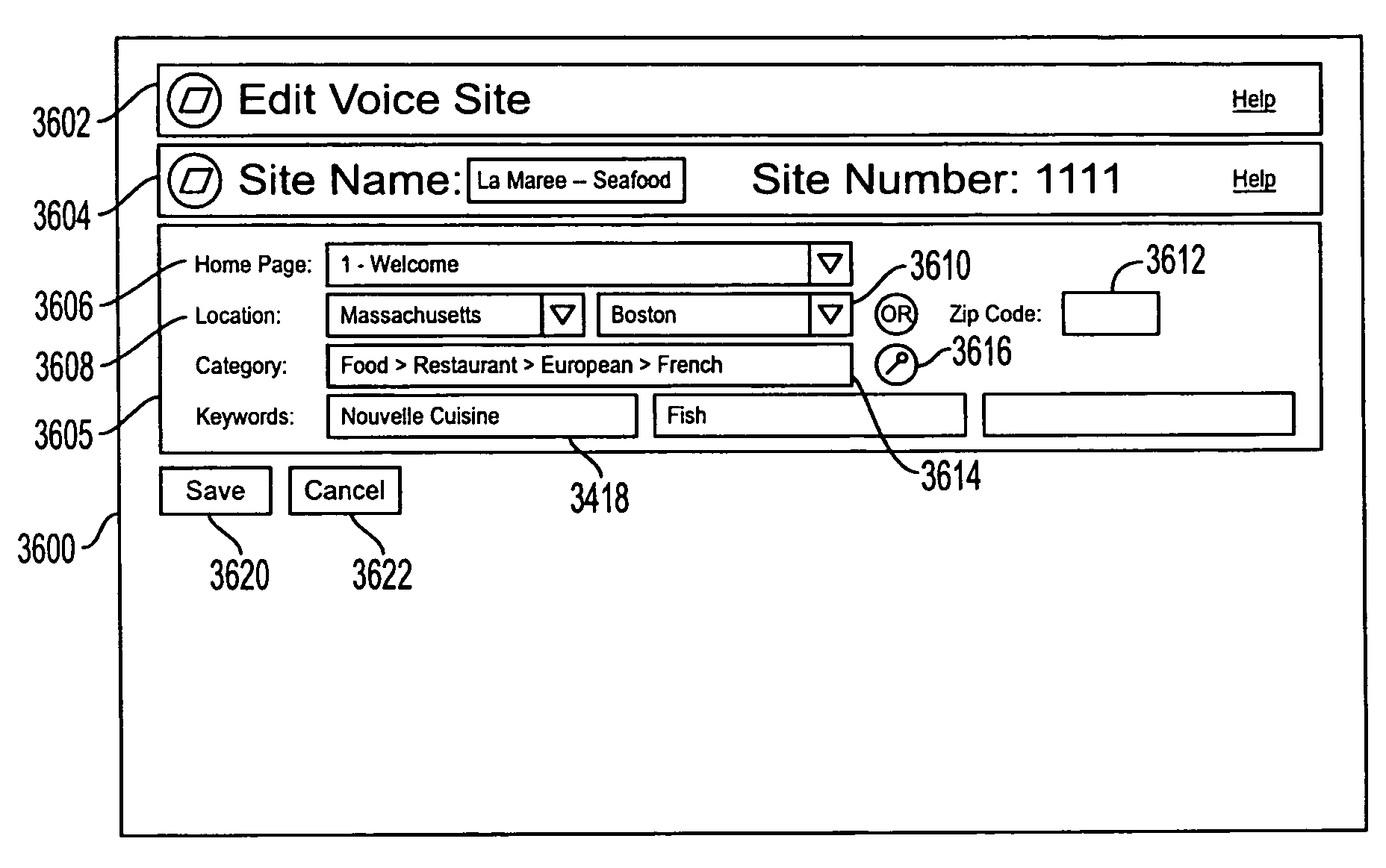

Voice page directory system in a voice page creation and delivery system

InactiveUS7457397B1Require lotSimplify creationAutomatic call-answering/message-recording/conversation-recordingAutomatic exchangesUser inputDirectory system

A voice page directory system for enabling users of a voice page delivery system to locate voice pages of interest. A database system stores location identification information and description information regarding a plurality of voice pages available to users through a voice page delivery system. Users then input voice page identifying information whereupon the system outputs a directory or searches voice pages based on keywords provided to output voice pages of interest.

Owner:GENESYS TELECOMMUNICATIONS LABORATORIES INC

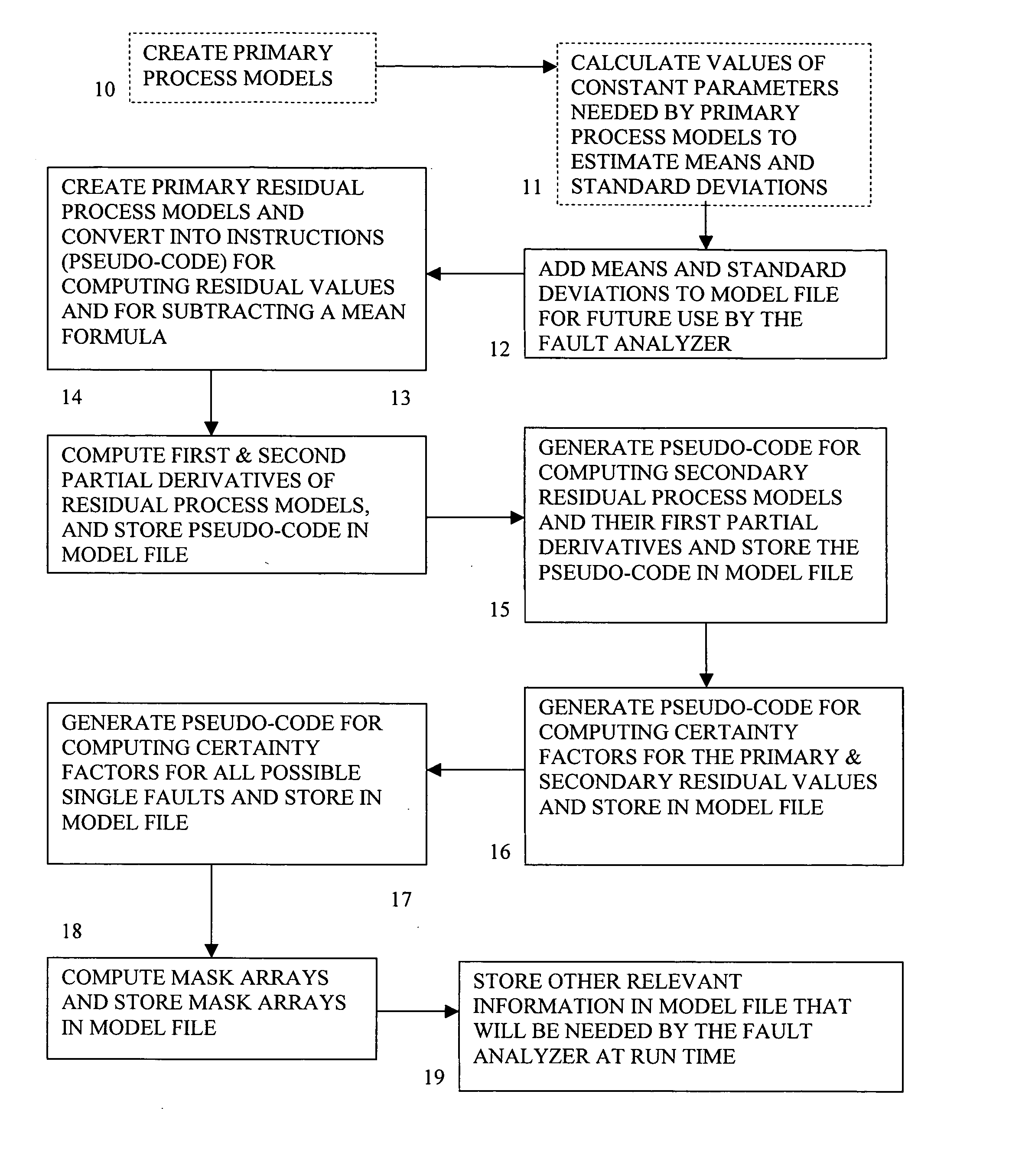

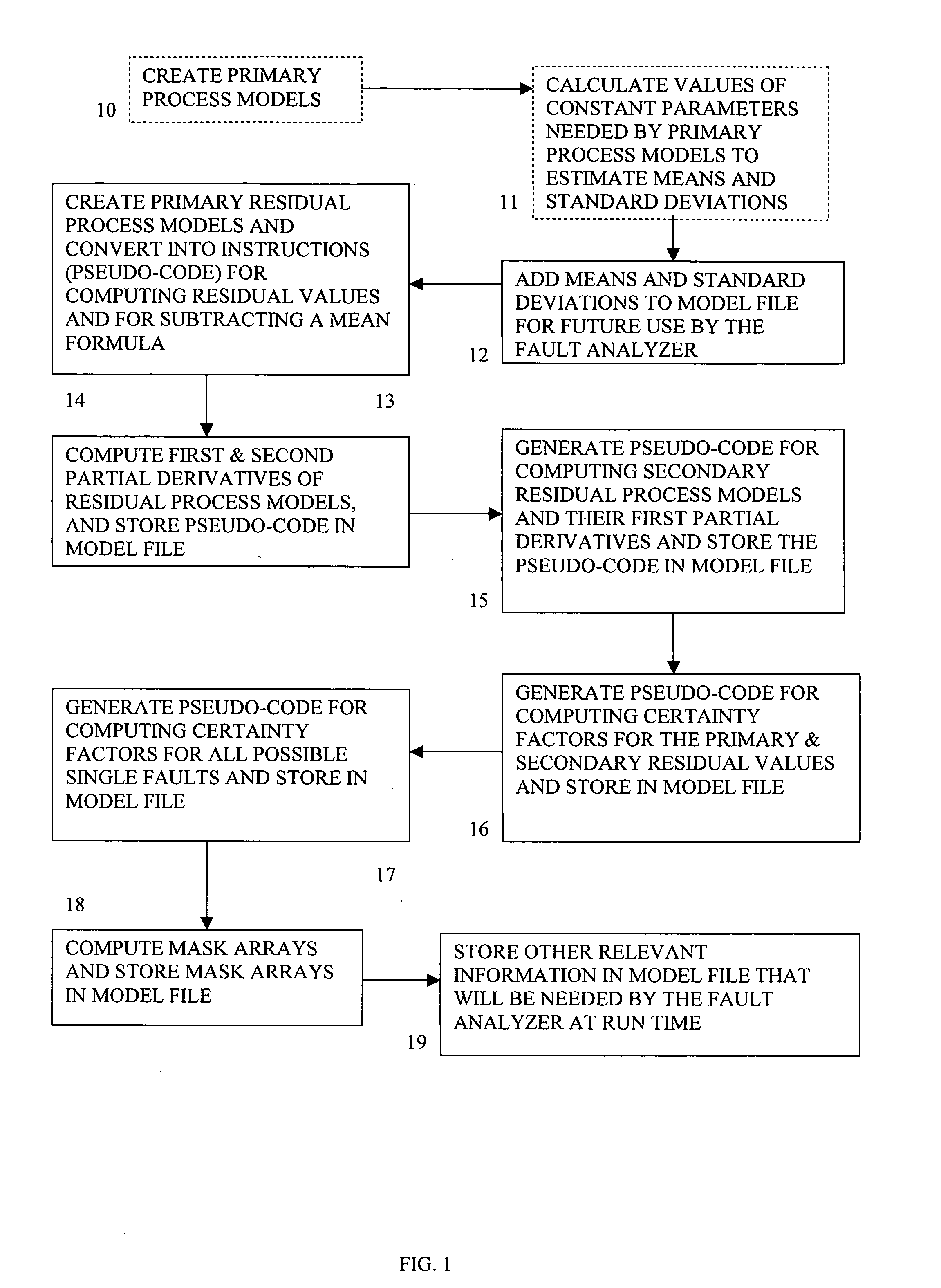

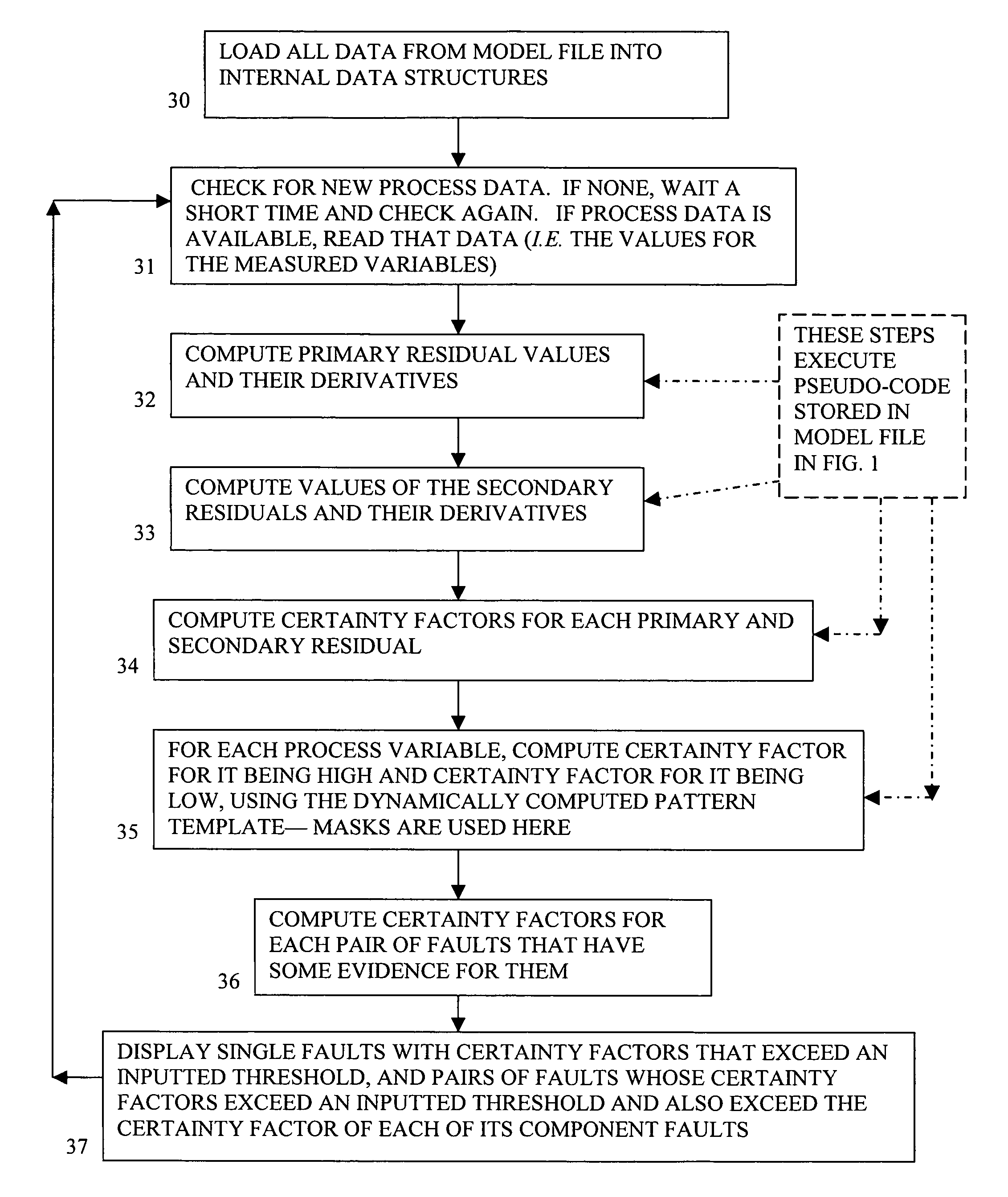

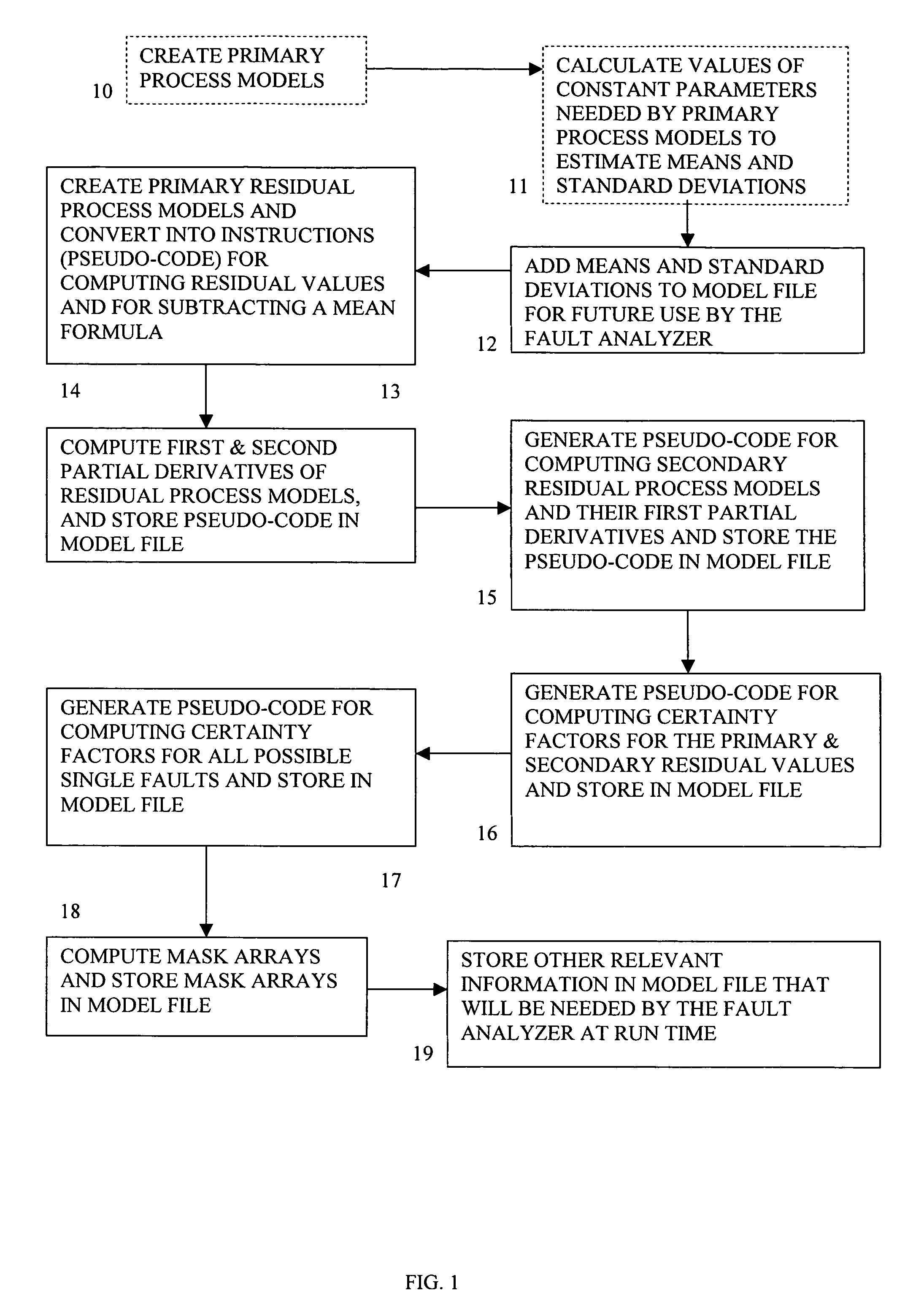

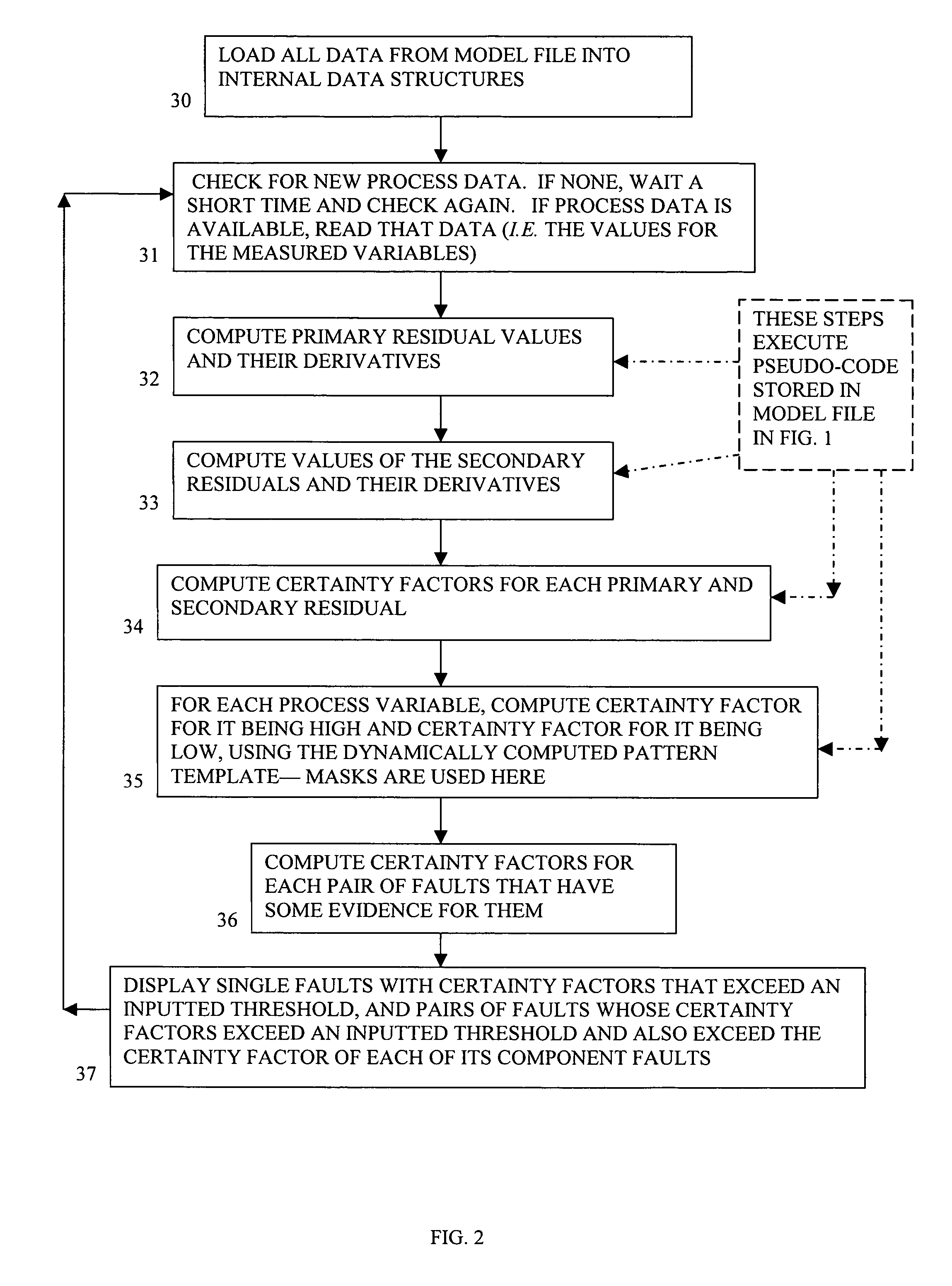

Method and system of monitoring, sensor validation and predictive fault analysis

InactiveUS20050210337A1Simplicity of implementationEasy maintenanceError detection/correctionElectric testing/monitoringLinear correlationPredictive failure analysis

The present invention provides an improved method and system for real-time monitoring, validation, optimization and predictive fault analysis in a process control system. The invention monitors process operations by continuously analyzing sensor measurements and providing predictive alarms using models of normal process operation and statistical parameters corresponding to normal process data, and generating secondary residual process models. The invention allows for the creation of a fault analyzer directly from linearly independent models of normal process operation, and provides for automatic generation from such process models of linearly dependent process models. Fuzzy logic is used in various fault situations to compute certainty factors to identify faults and / or validate underlying assumptions. In one aspect, the invention includes a real-time sensor data communications bridge module; a state transition logic module; a sensor validation and predictive fault analysis module; and a statistical process control module; wherein each of the modules operates simultaneously.

Owner:FALCONEER TECH

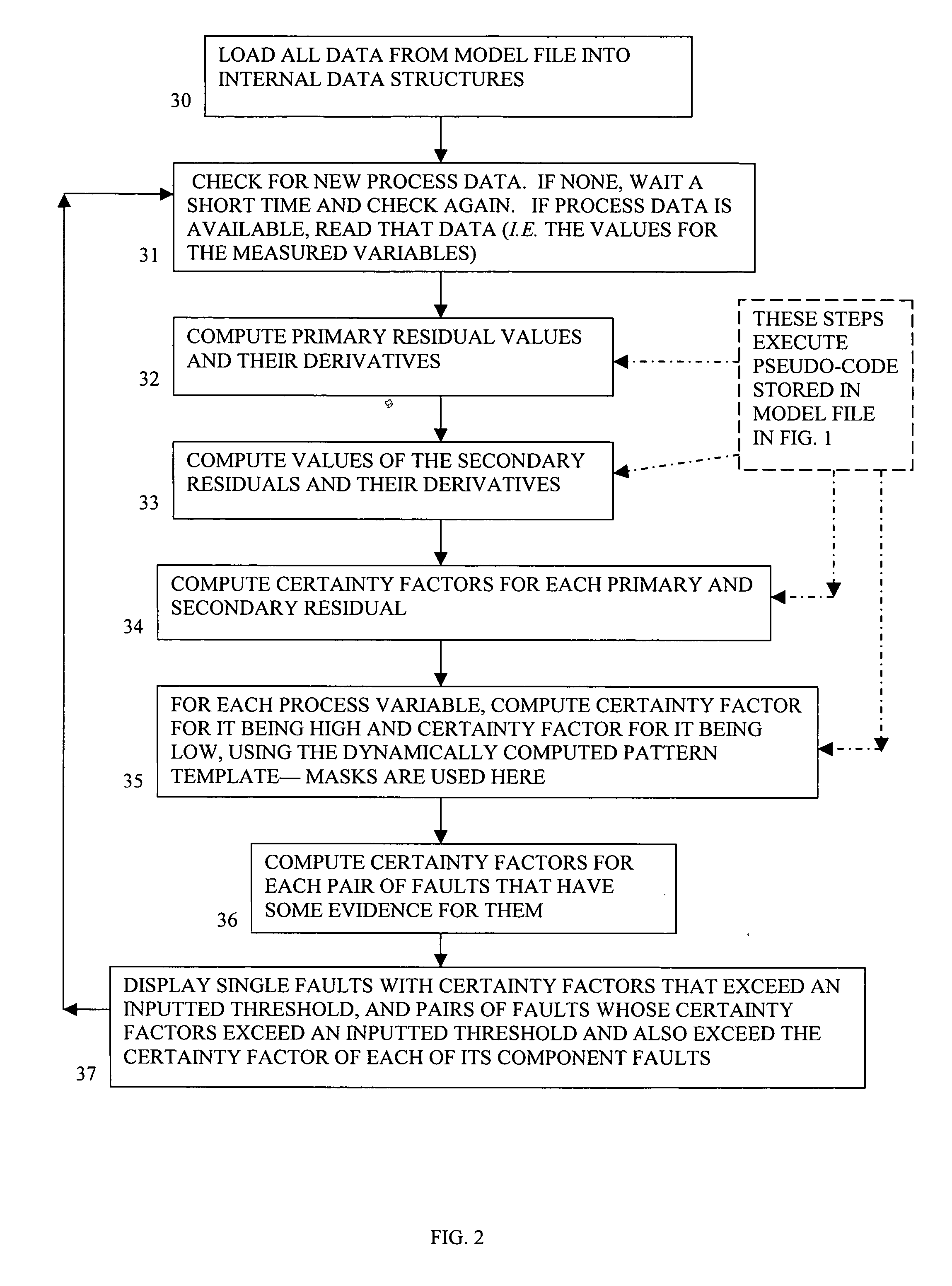

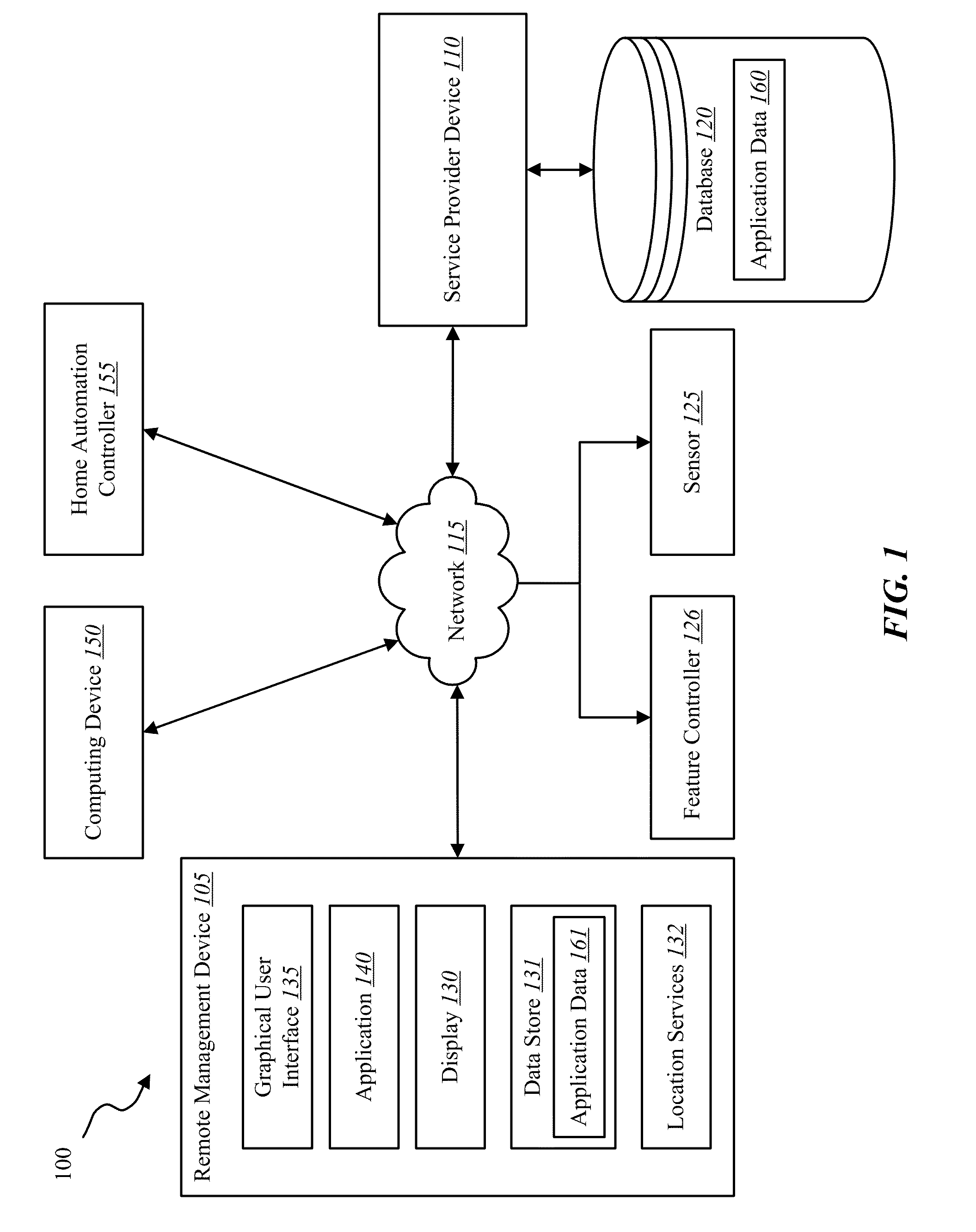

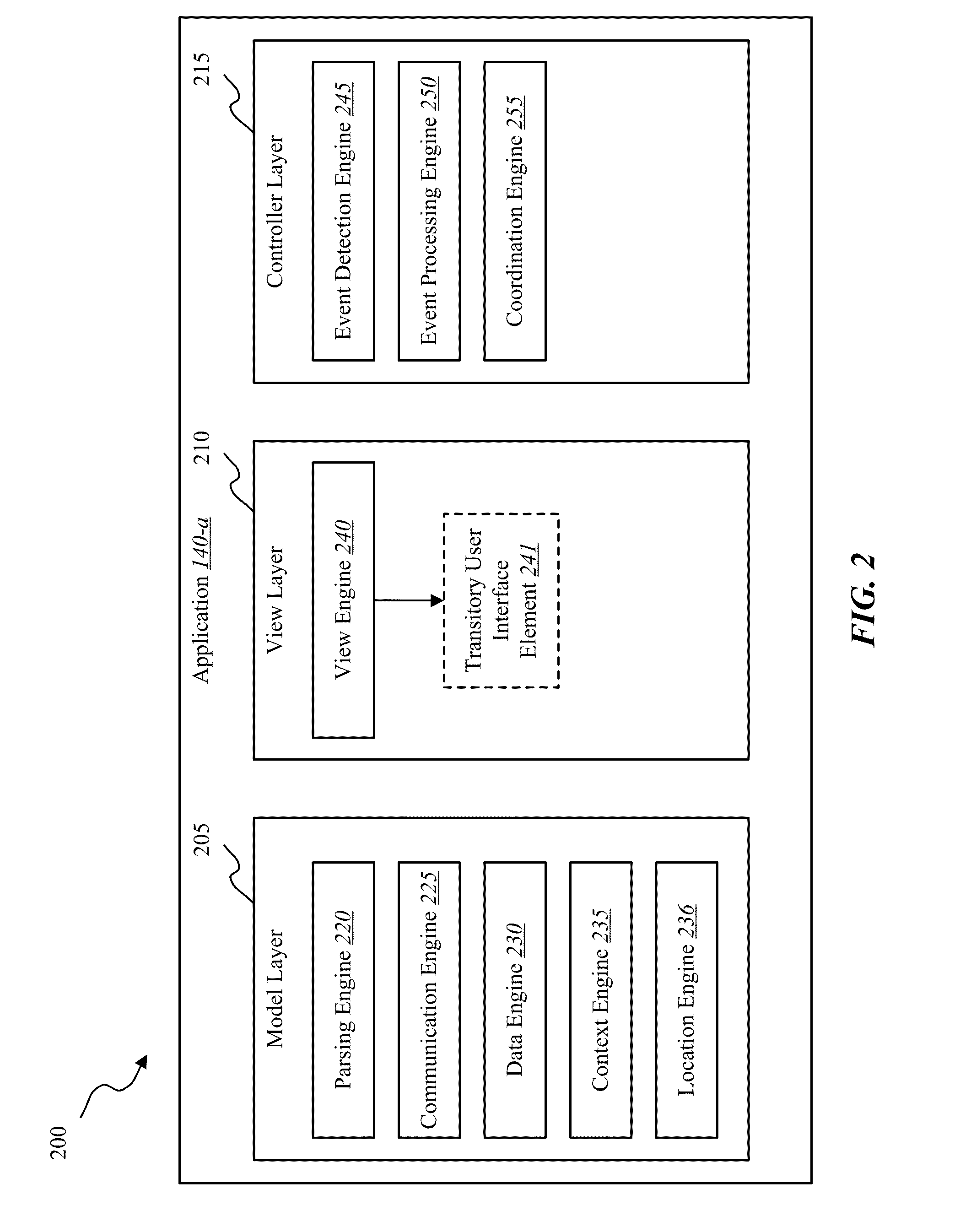

Systems and methods for home automation scene control

ActiveUS20150082225A1Simplify creationRobust and flexibleAlarmsHome automation networksGraphicsGraphical user interface

Methods and systems are described for providing a graphical user interface suitable for viewing and modifying home automation, home security, and / or energy management devices. In some embodiments, the graphical user interface may include a scene selection list displaying multiple selectable items representing various scenes. In certain instances, control and monitoring of one or more devices may at least be accessed through a transitory user interface element such as, for example, a drawer control, a pullable view, or the like. Multiple device states may be set in accordance with a scene definition associated with a selectable list item in a scene selection list displayed in the transitory user interface element. The contents of the scene selection, in certain embodiments, may be determined in part based on a detected application context, user context, or both.

Owner:VIVINT INC

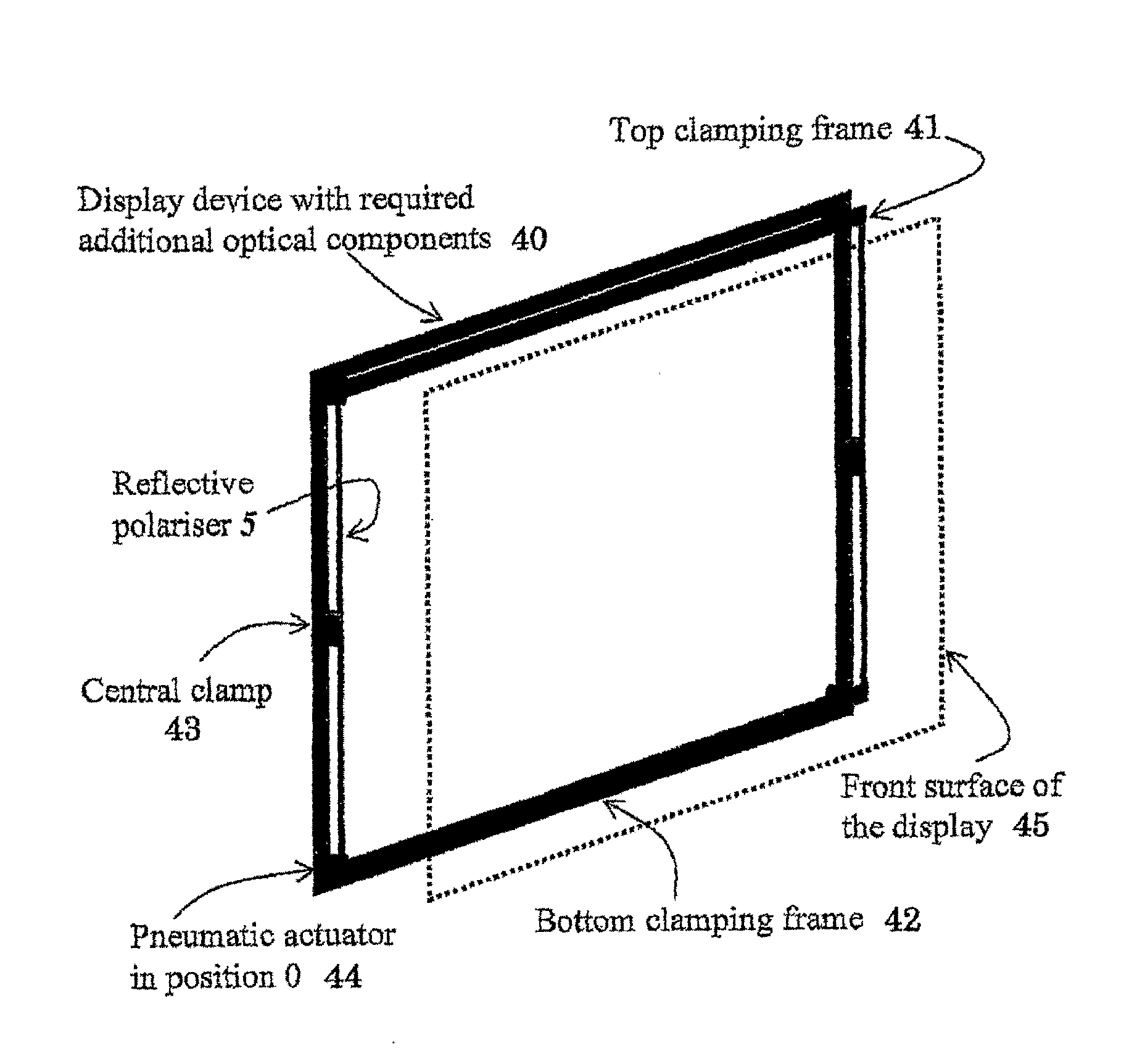

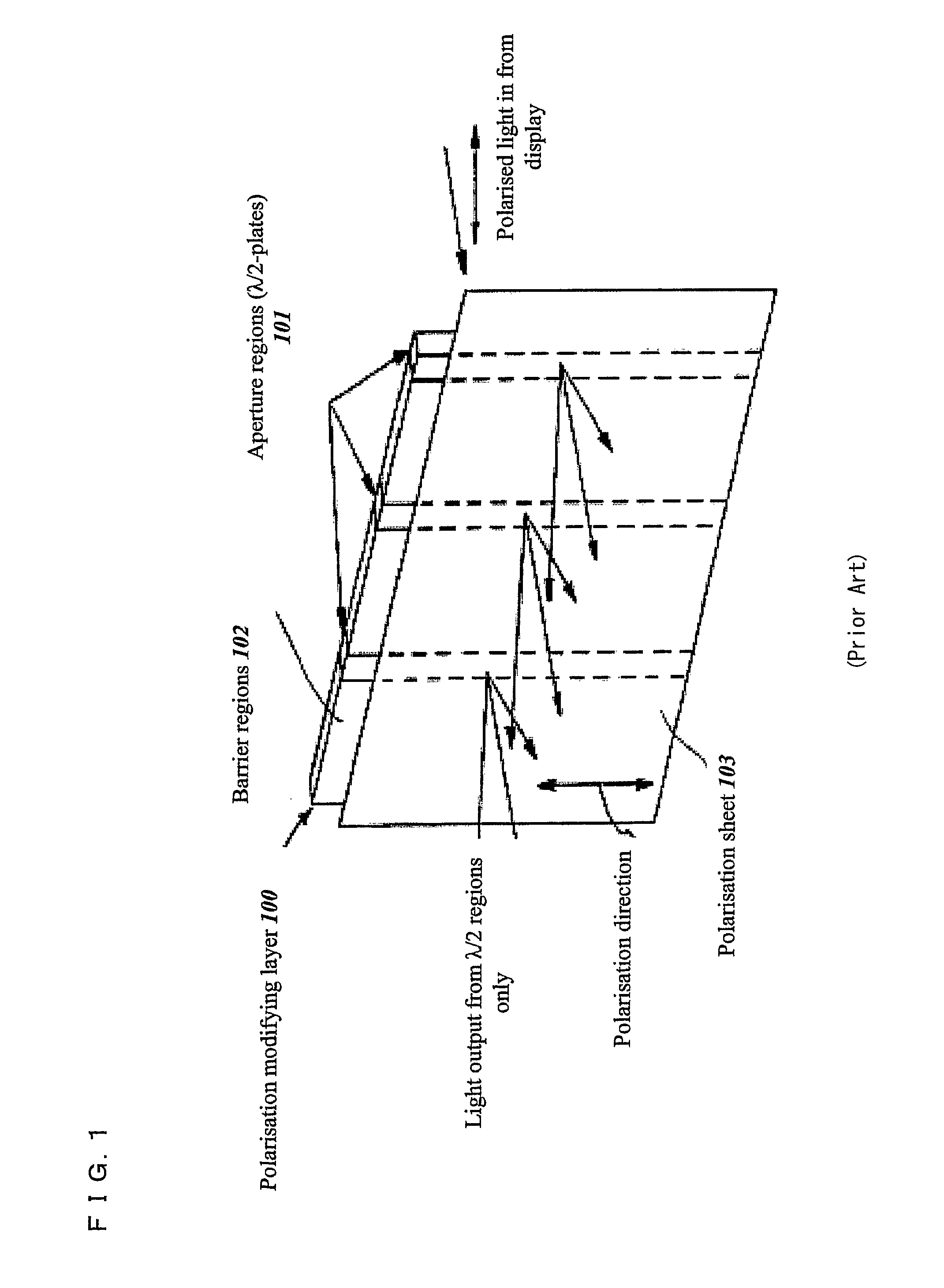

Optical system and display

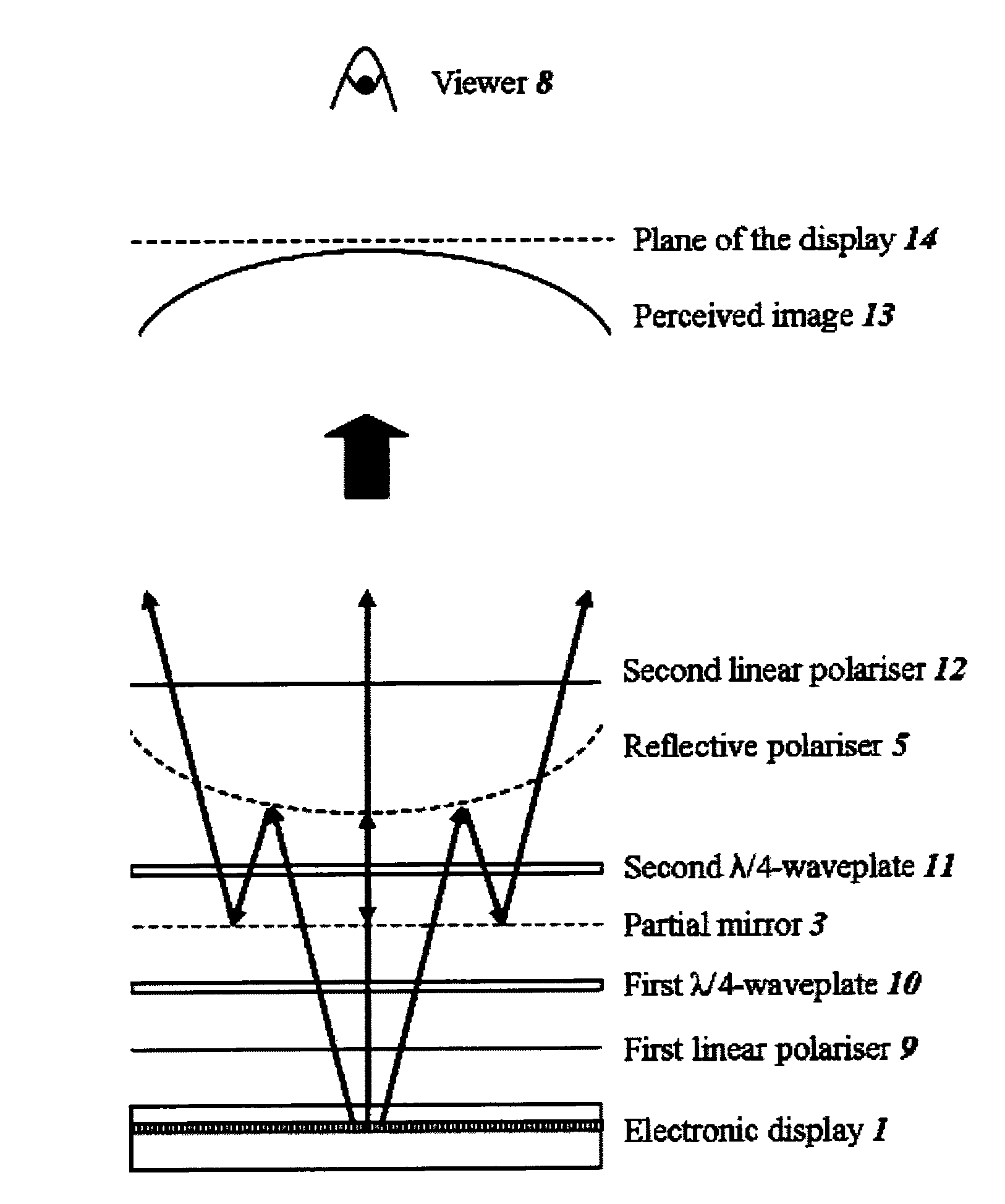

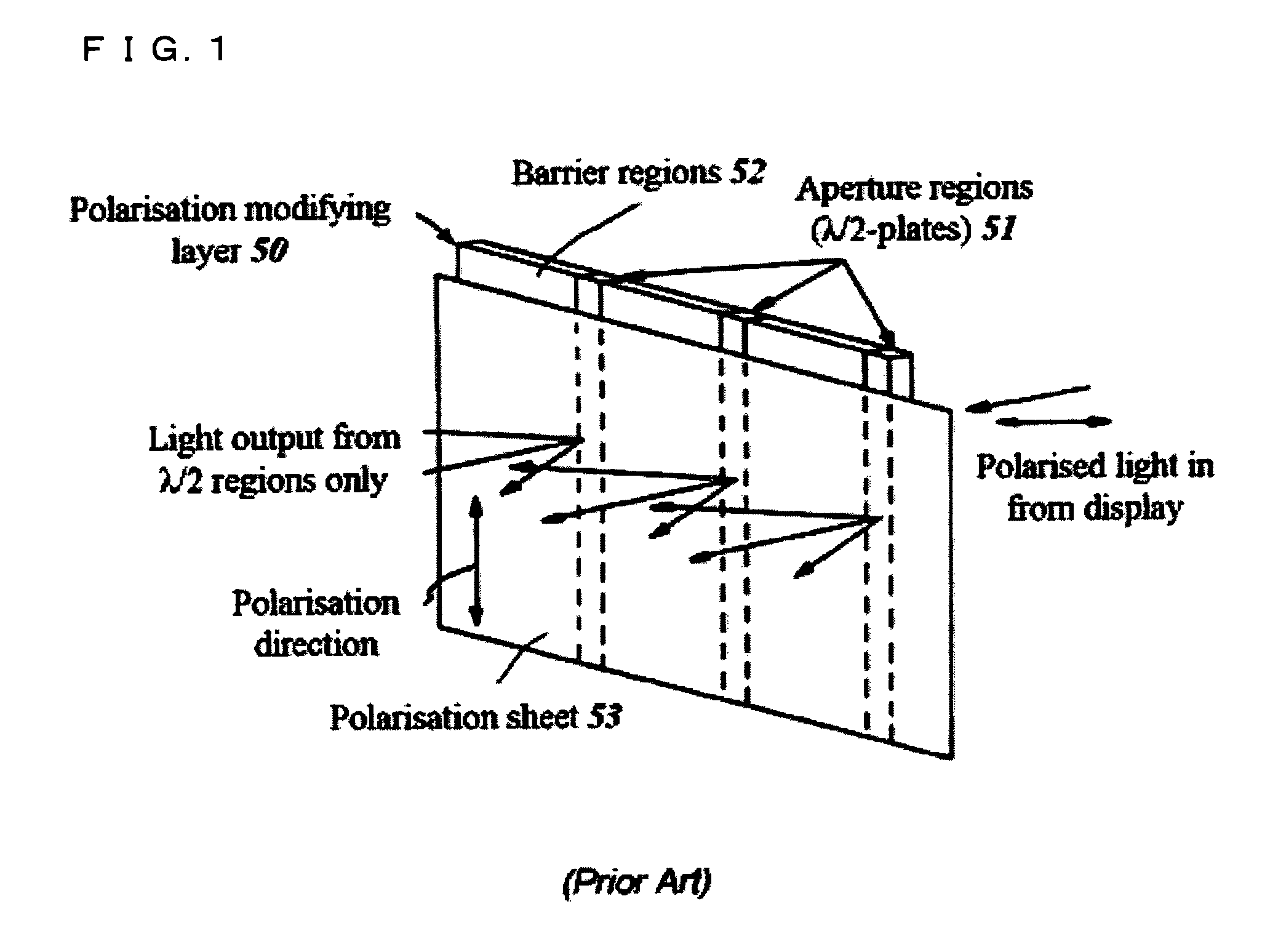

An optical system is provided, for example for use with a display device, for varying the shape of a surface in which an image displayed by the display device is perceived. The optical system comprises first and second spaced-apart partial reflectors, at least one of which is switchable between a first non-flat shape and a second different shape, which may be flat or non-flat. The reflectors, together with polarisation optics, provide a light path such that light from the display is at least partially transmitted by the first reflector, partially reflected by the second reflector, partially reflected by the first reflector and partially transmitted by the second reflector. Light which does not follow the light path is prevented from leaving the optical system.

Owner:SHARP KK

Optical system and display that converts a flat image to a non-flat image

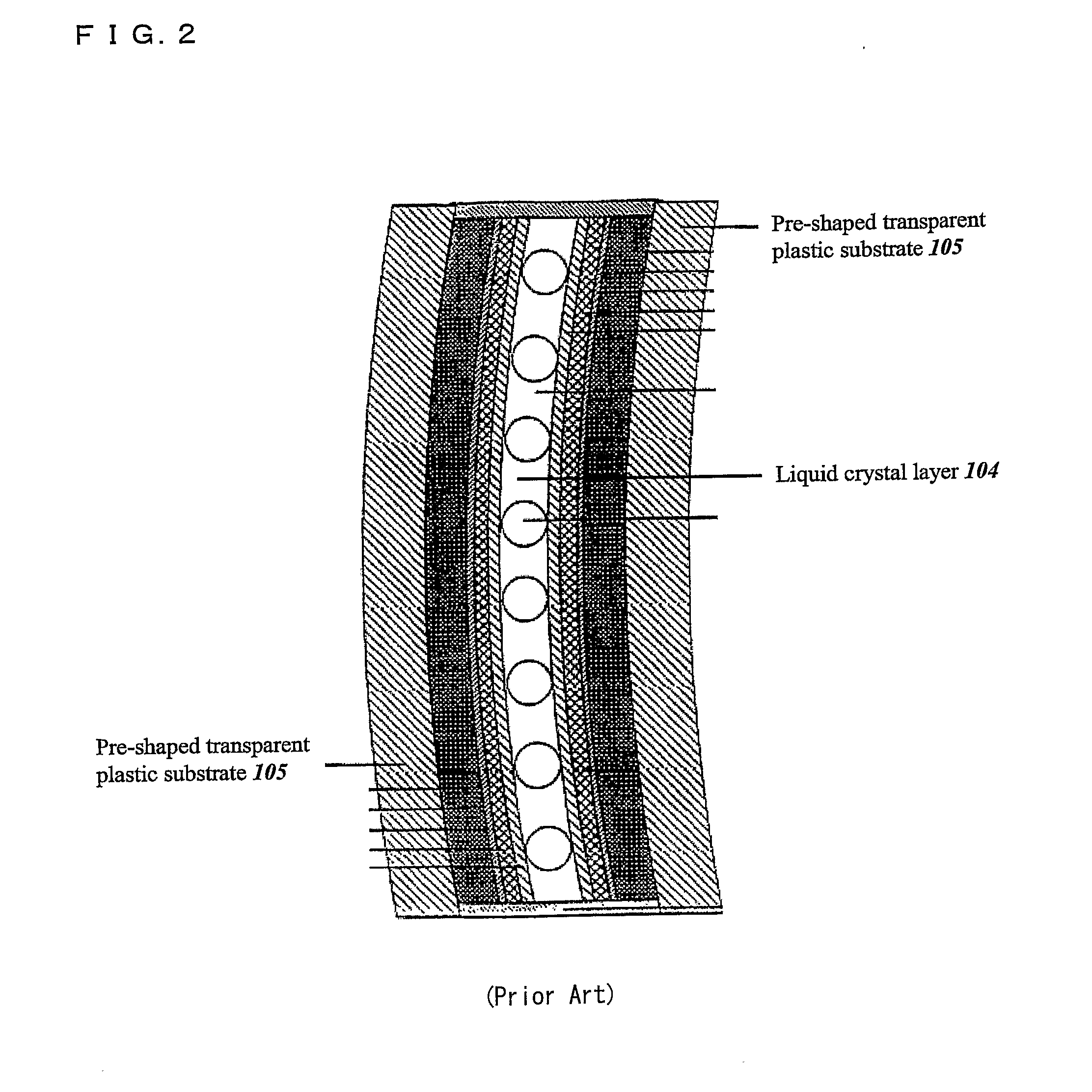

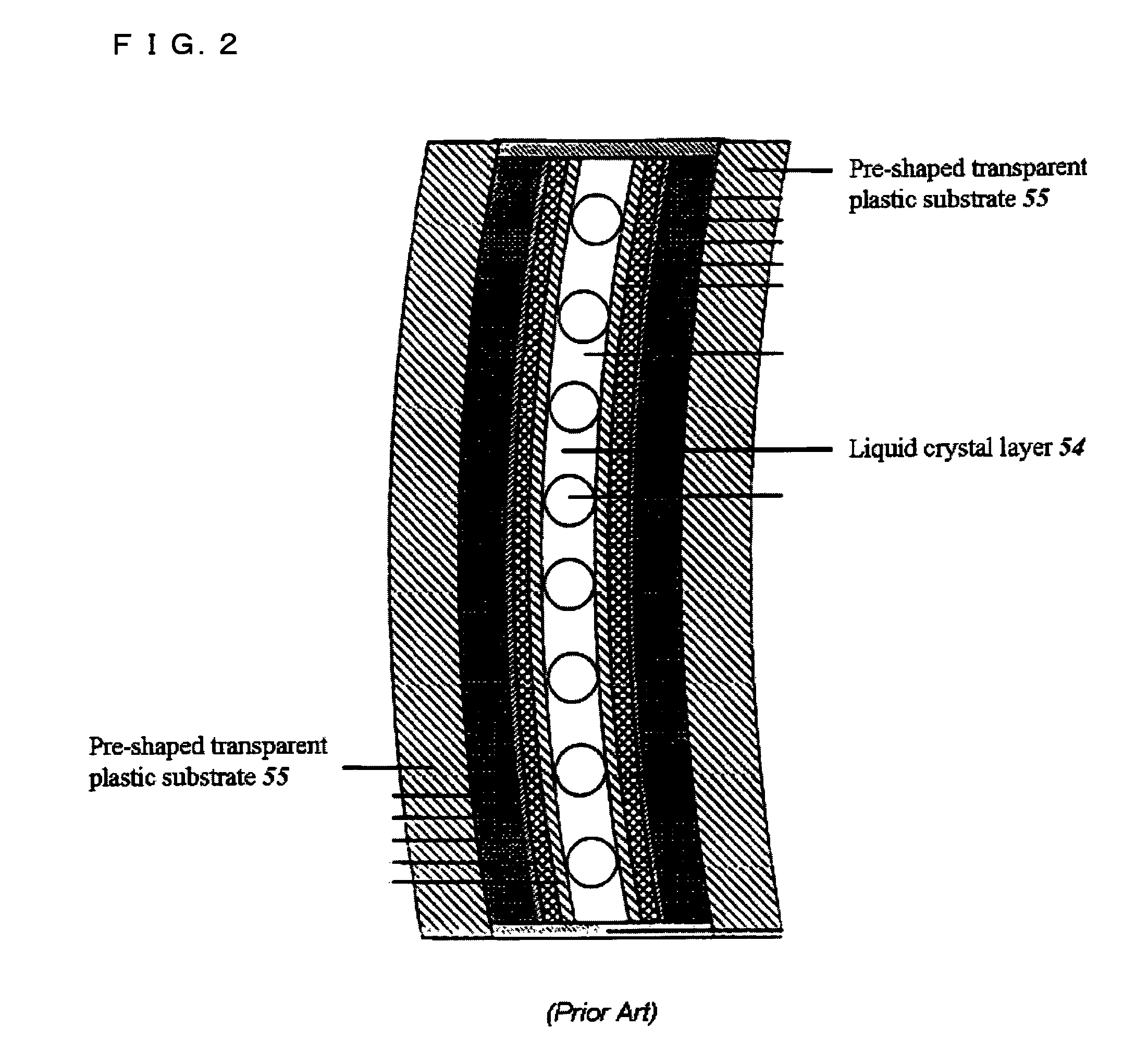

InactiveUS8493520B2Avoid emissionsSimplify creationCathode-ray tube indicatorsNon-linear opticsDisplay deviceOptoelectronics

An optical system is provided for use with a display device to convert a flat image from the display device to a non-flat image. The optical system comprises first and second spaced-apart partial reflectors, at least one of which is non-flat. The reflectors, together with polarization optics, provide a light path such that light from the display is at least partially transmitted by the first reflector, partially reflected by the second reflector, partially reflected by the first reflector and partially transmitted by the second reflector so that a viewer perceives a non-flat, for example curved, image. Light which does not follow the light path is prevented from leaving the optical system.

Owner:SHARP KK

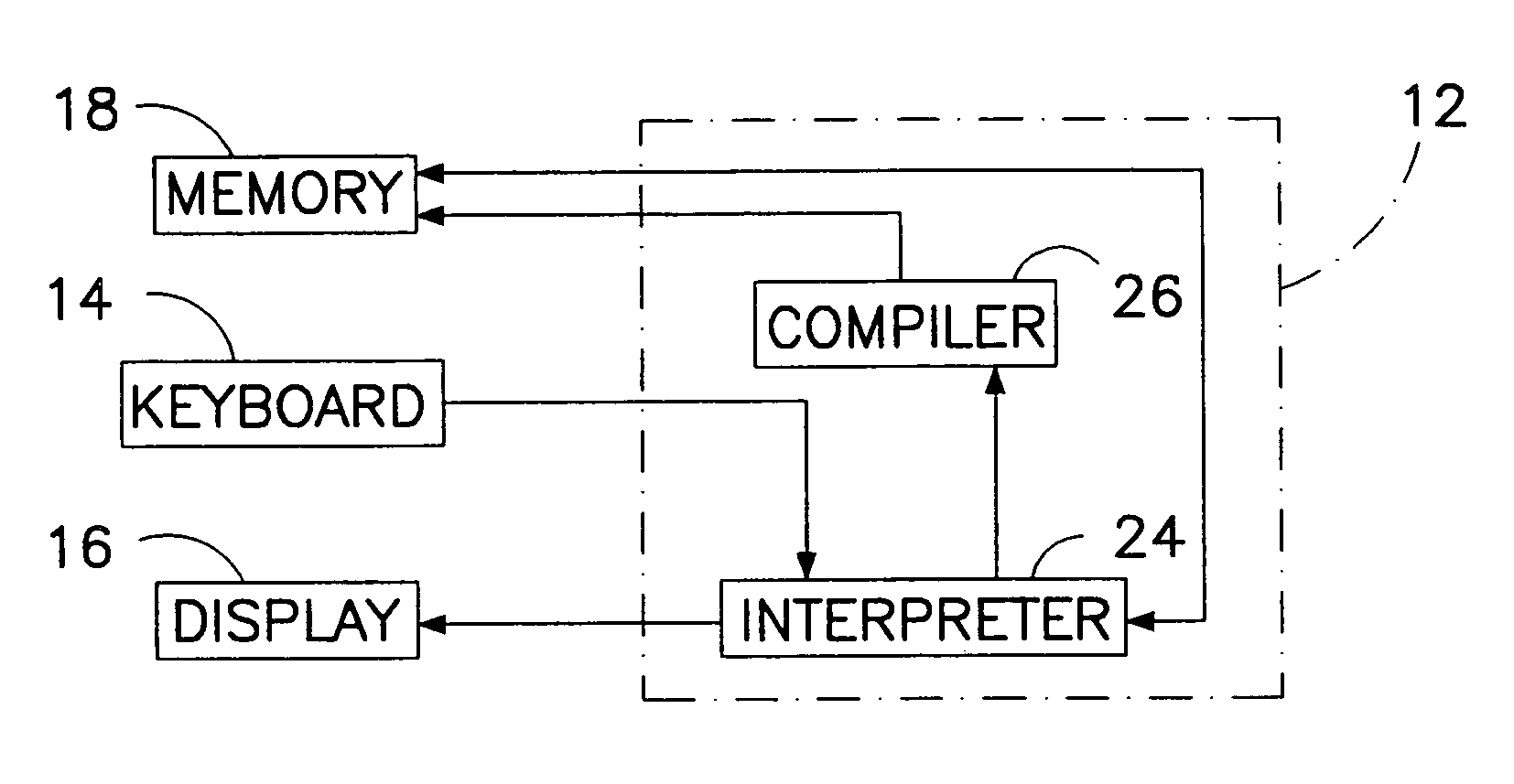

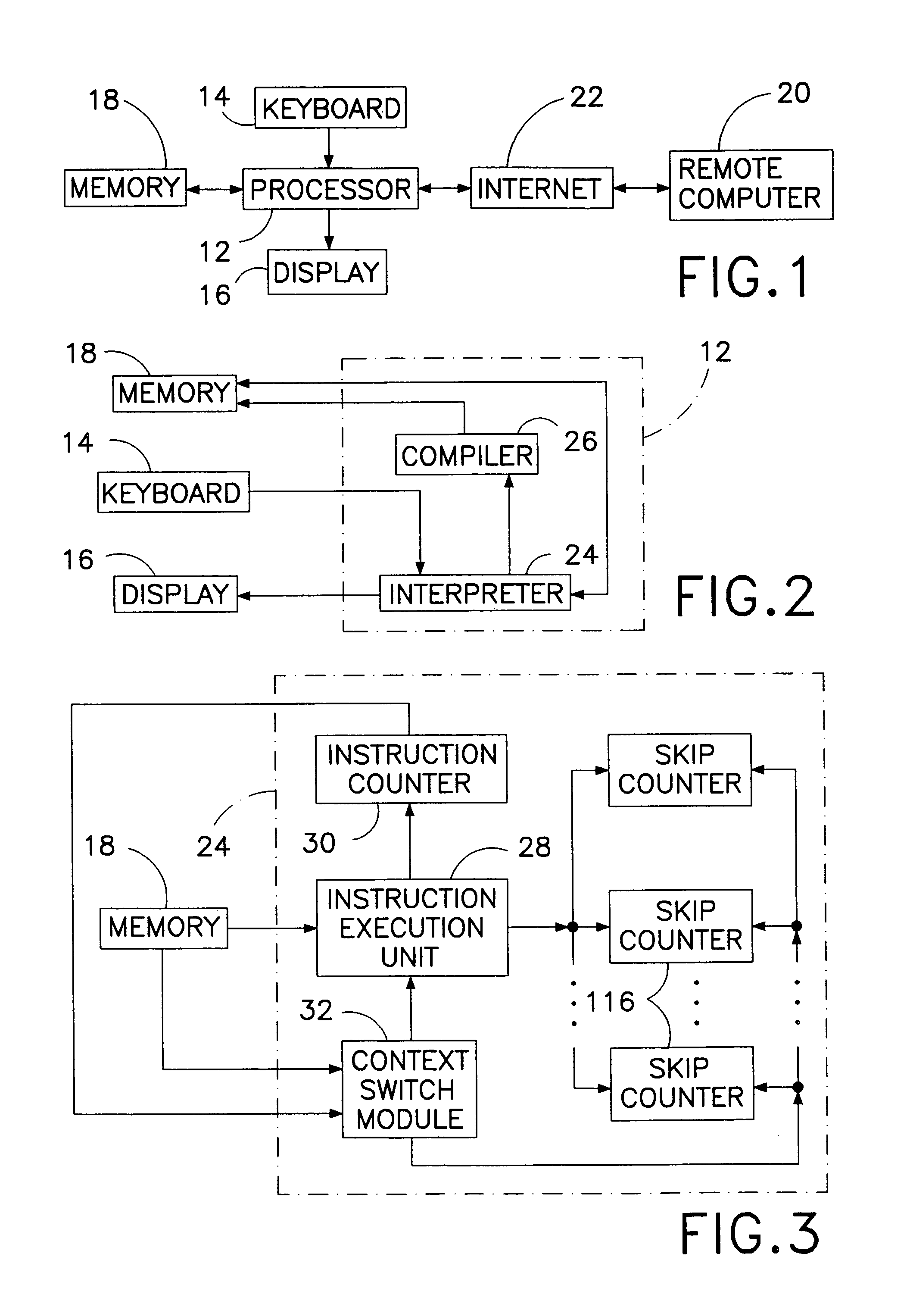

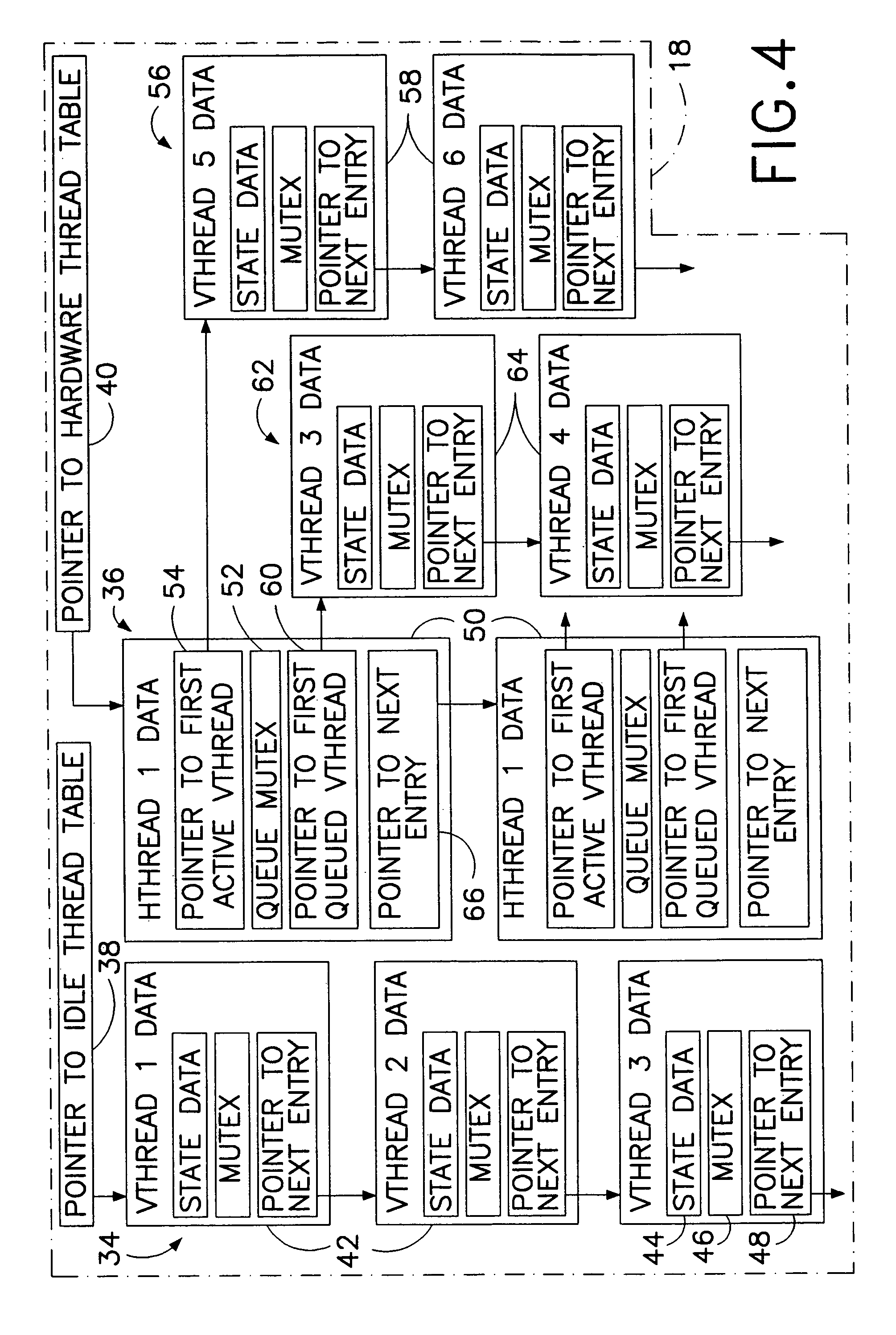

Computer multi-tasking via virtual threading using an interpreter

InactiveUS7234139B1Eliminate dependenciesDifferent operationalProgram initiation/switchingInterprogram communicationLocal variablePseudocode

In the operation of a computer, a plurality of bytecode or pseudocode instructions, at least some of the pseudocode instructions comprising a plurality of machine code instructions, are stored in a computer memory. For each of a plurality of tasks or jobs to be performed by the computer, a respective virtual thread of execution context data is automatically created. The virtual threads each include (a) a memory location of a next one of the pseudocode instructions to be executed in carrying out the respective task or job and (b) the values of any local variables required for carrying out the respective task or job. At least some of the tasks or jobs each entails execution of a respective one of the pseudocode instructions comprising a plurality of machine language instructions. Each of the tasks or jobs are processed in a respective series of time slices or processing slots under the control of the respective virtual thread, and, in every context switch between different virtual threads, such context switch is undertaken only after completed execution of a currently executing one of the pseudocode instructions.

Owner:CERINET USA

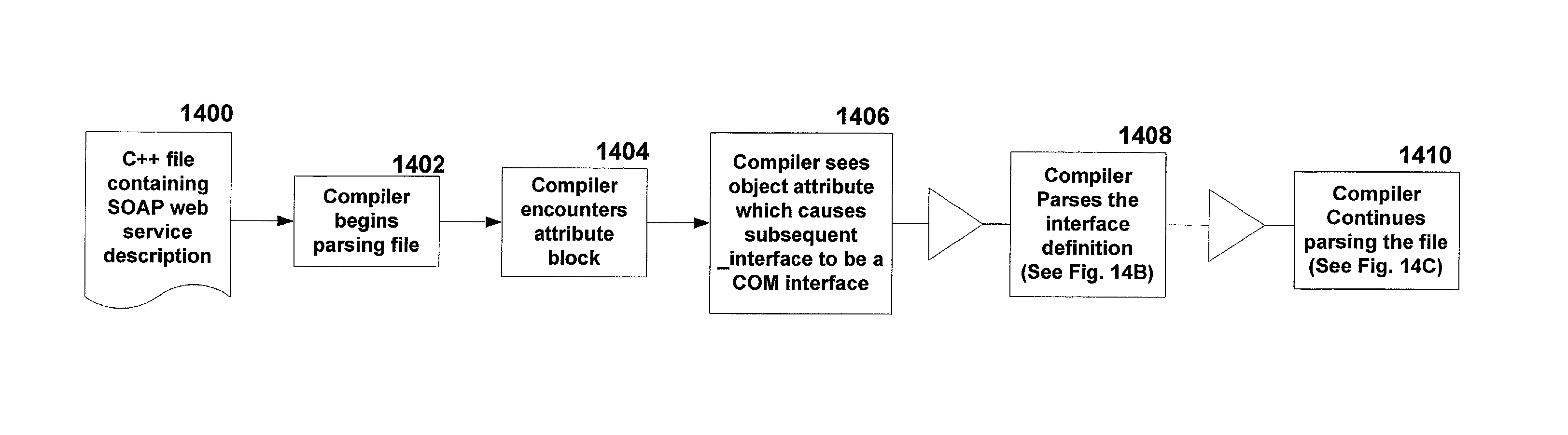

System and methods for providing a declarative syntax for specifying SOAP-based web services

InactiveUS7055143B2Minimizes code amountSimplify creationSoftware designTransmissionWeb serviceSyntax

Owner:MICROSOFT TECH LICENSING LLC

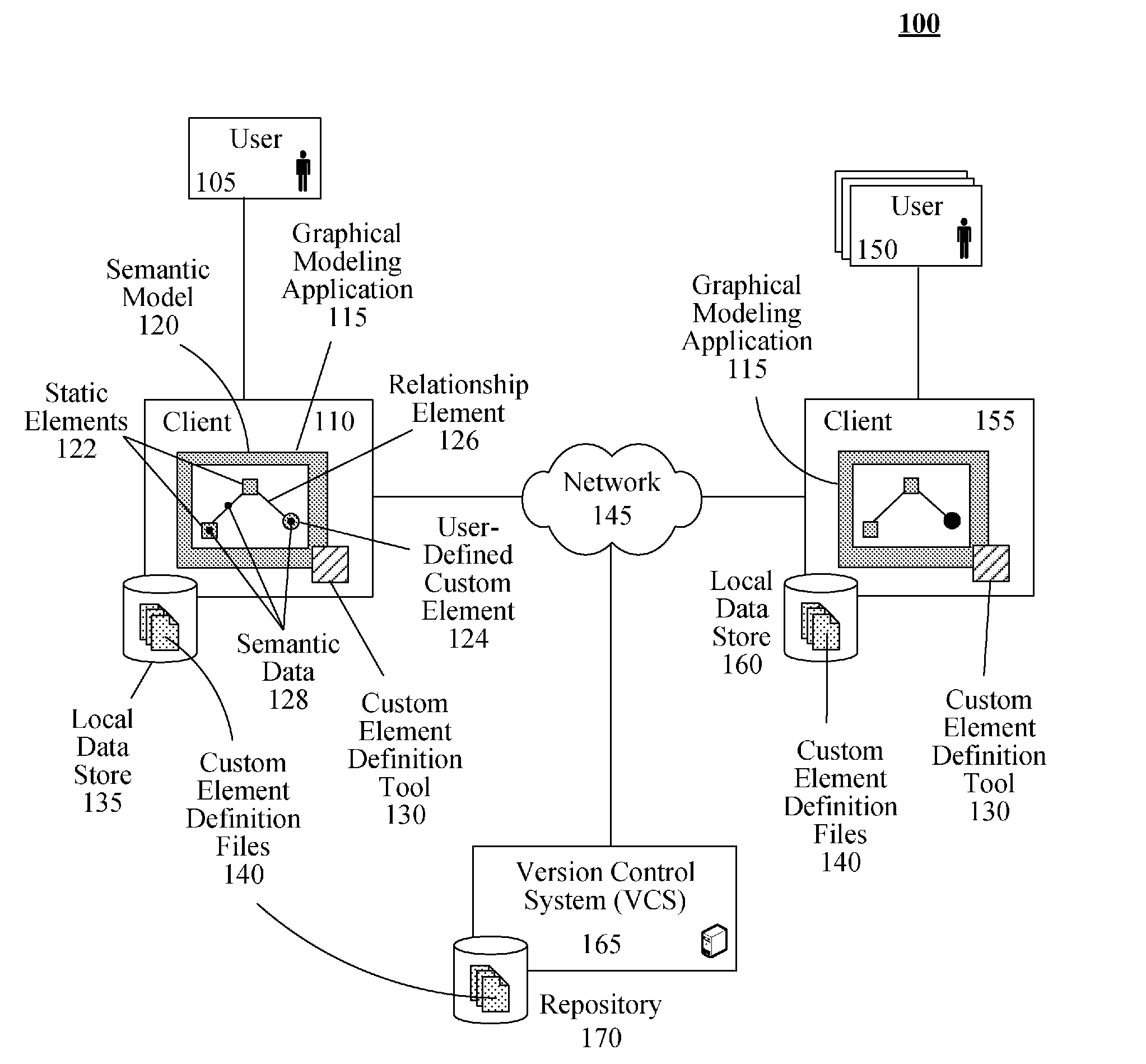

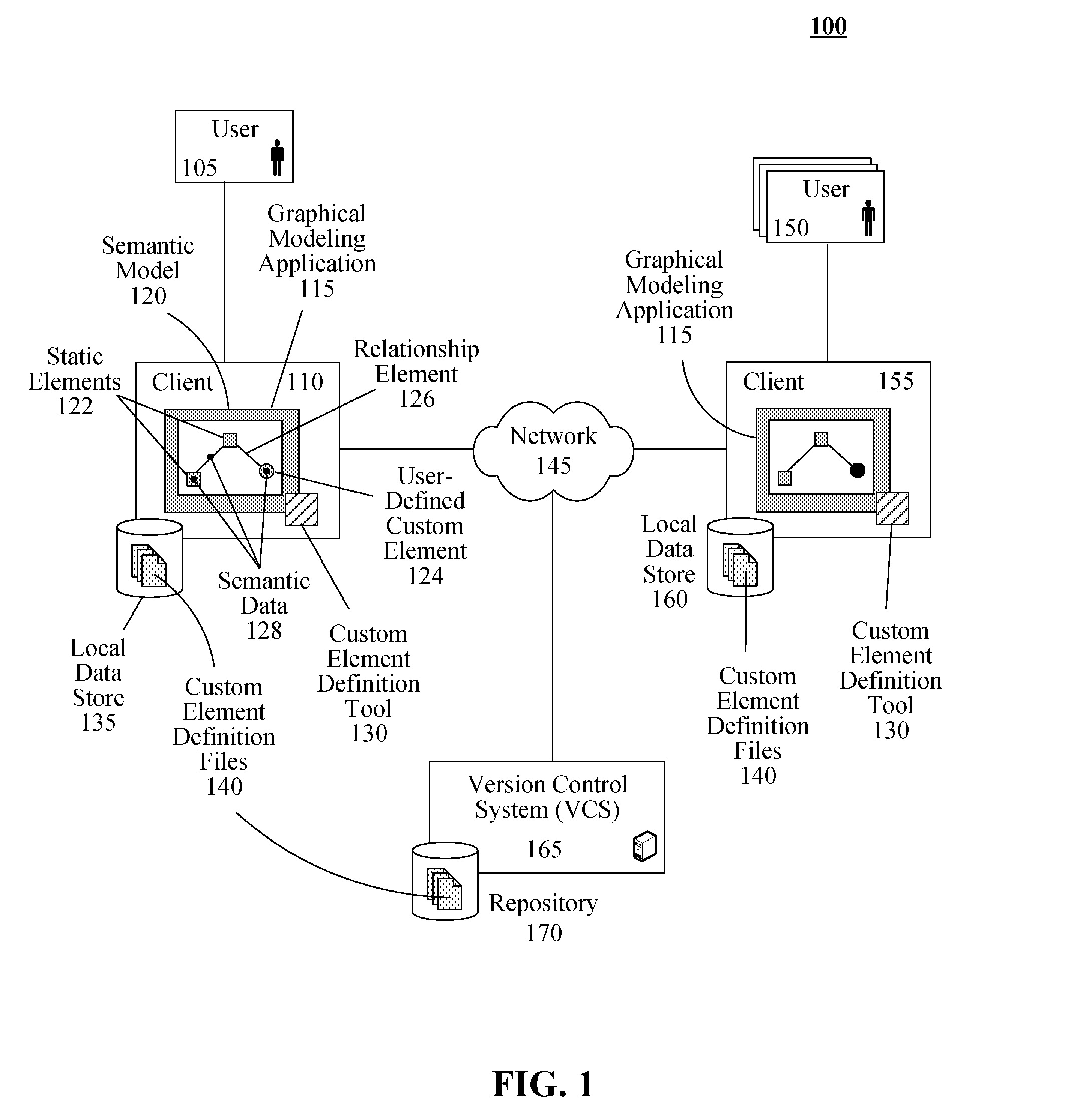

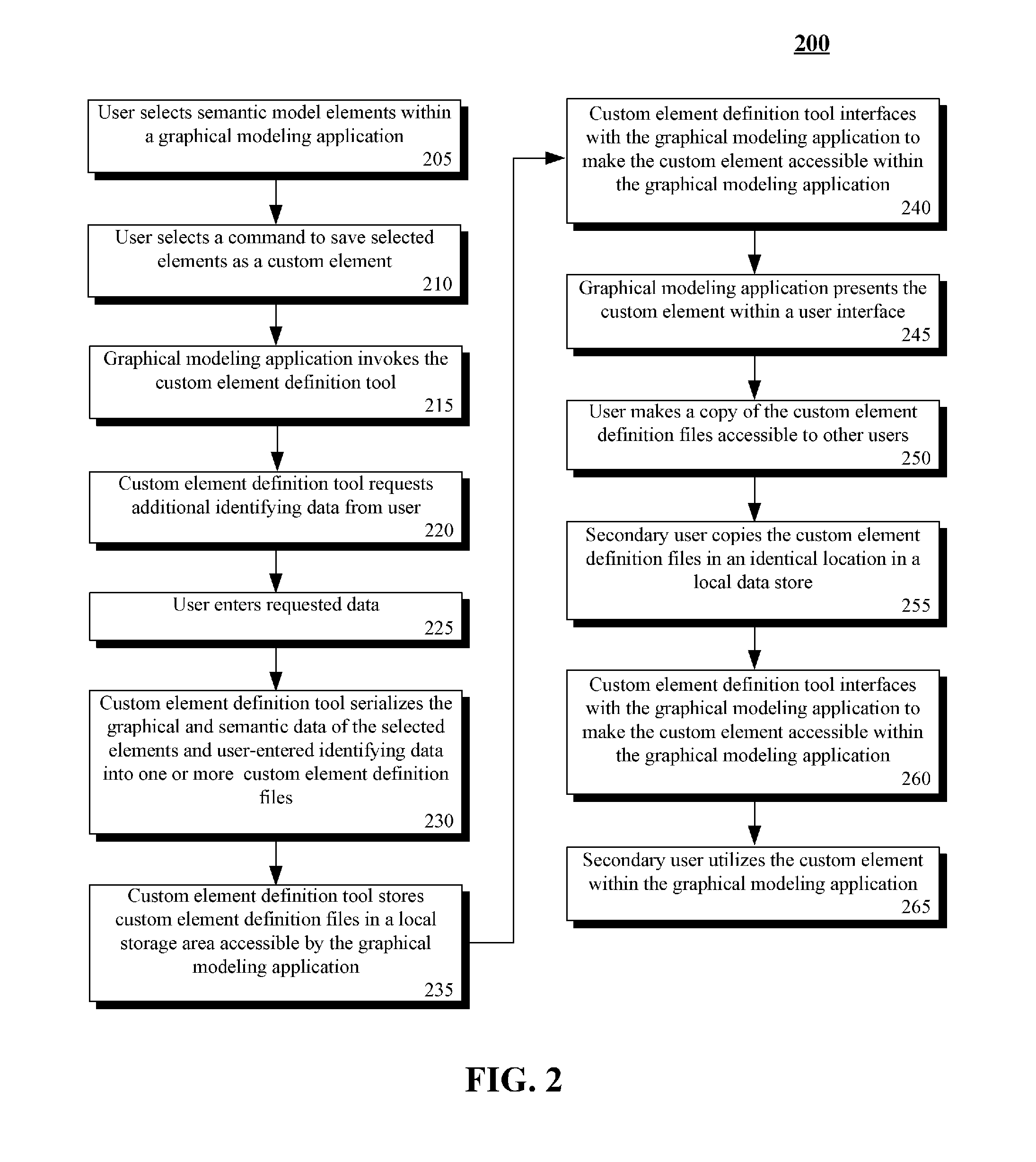

Simplifying the creation of user-defined custom elements for use in a graphical modeling application

ActiveUS20090319467A1Simplify creationKnowledge representationInference methodsProgramming languageGraphics

The present invention can include a solution for capturing user-defined custom elements for use in a graphical modeling application. Such a system can include a graphical modeling application and a custom element definition tool. The graphical modeling application can be configured to create semantic models that contain a static graphical elements and semantic data elements. The custom element definition tool can be configured to create a user-defined custom element for the graphical modeling application. The user-defined custom element can consist of one or more static graphical element and / or one or more semantic data element.

Owner:IBM CORP

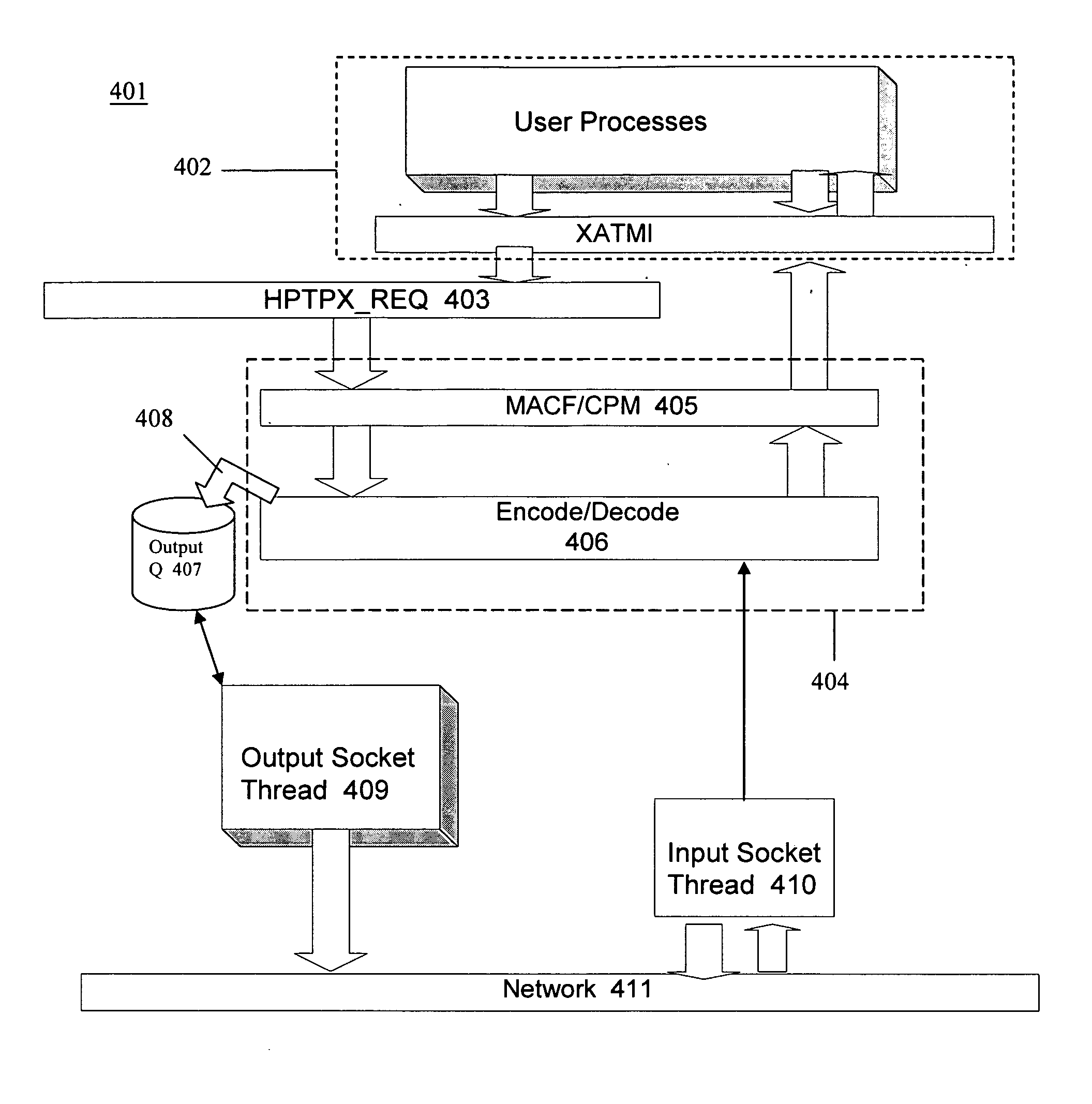

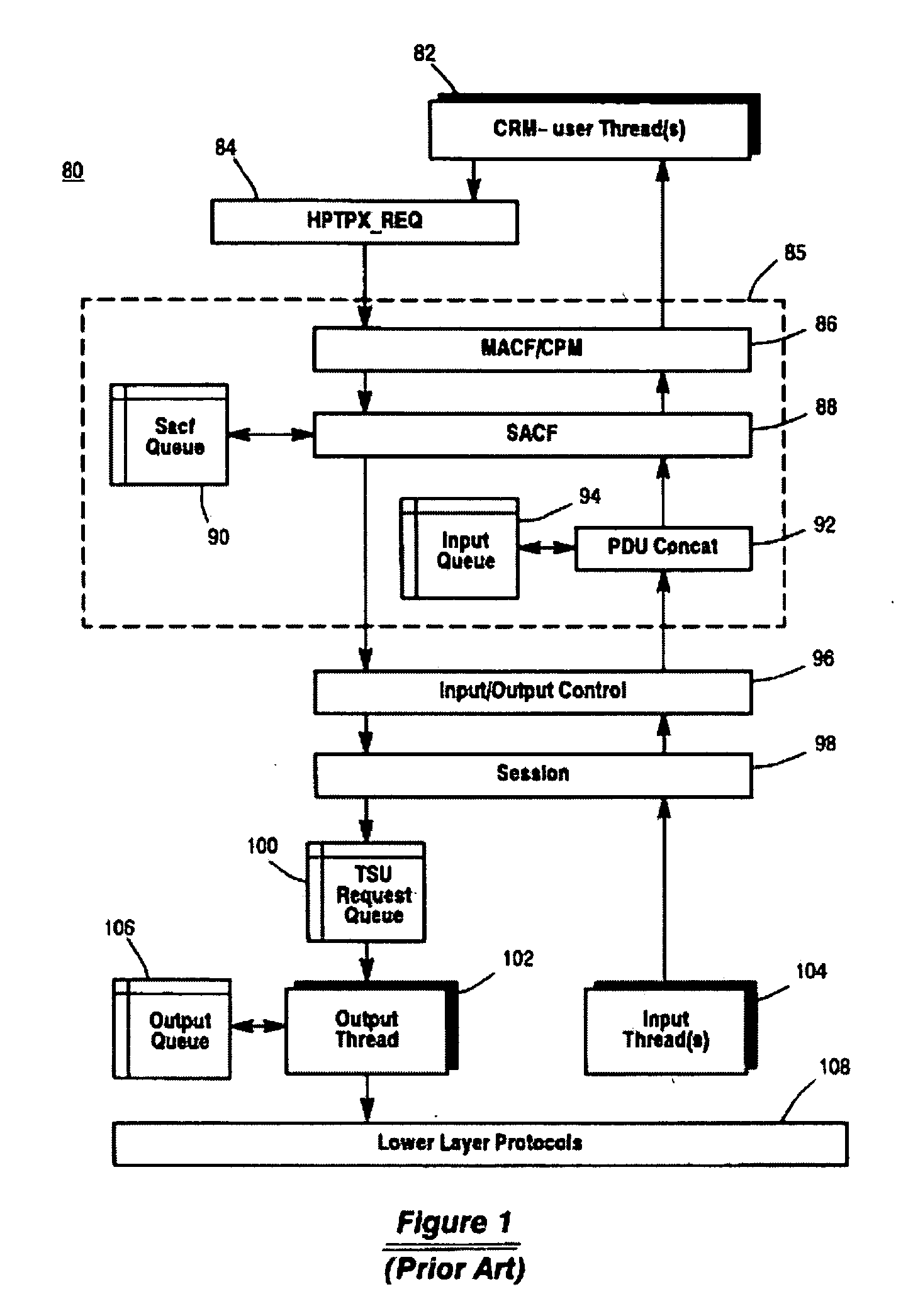

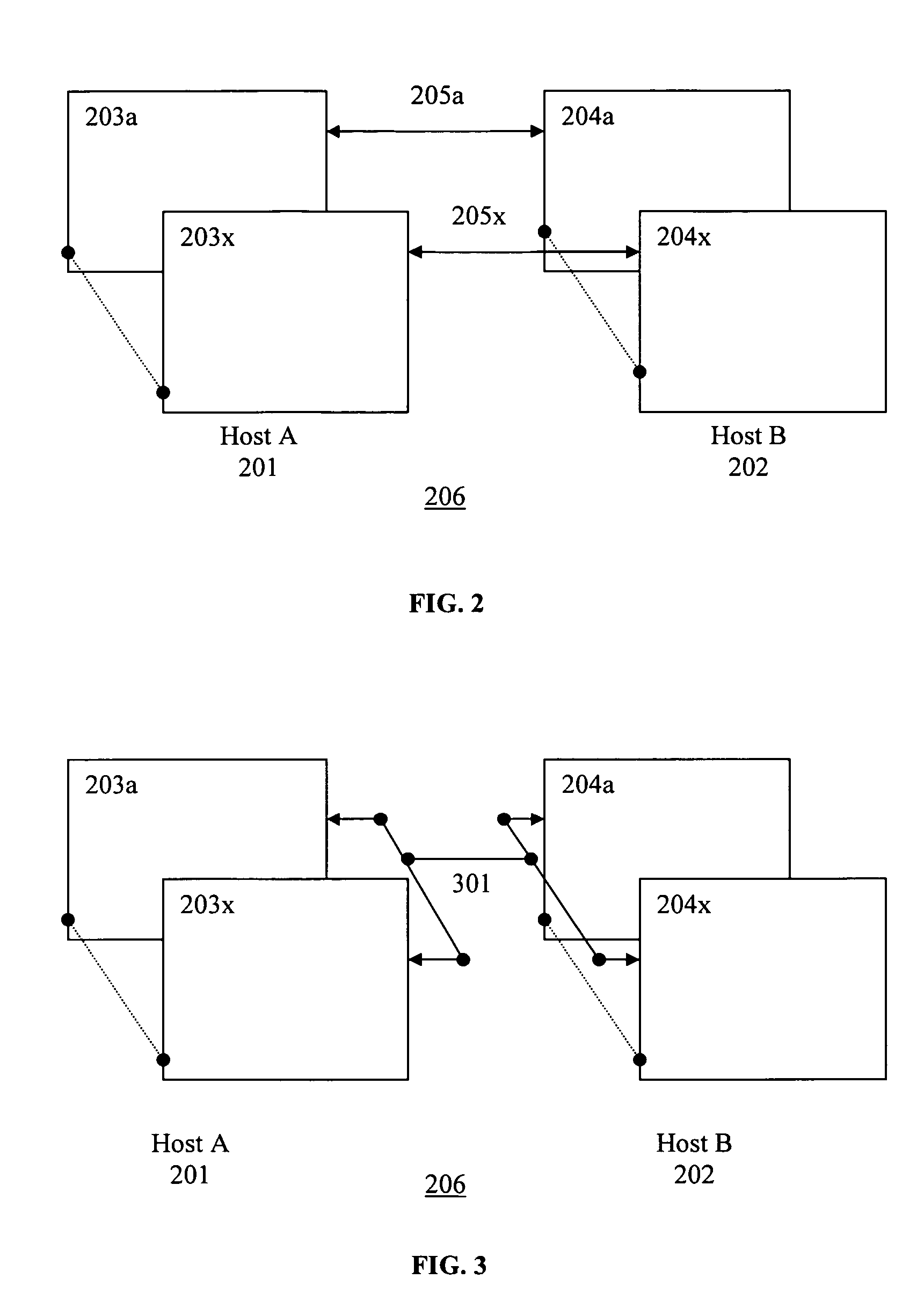

Message transfer using multiplexed connections in an open system interconnection transaction processing environment

InactiveUS20050193056A1Less complexSimpler connection creationMultiple digital computer combinationsSecuring communicationMessage lengthMultiplexing

Novel message formats for use in a distributed transaction environment are disclosed. Each message includes a message type field, a message length field, and a data field, typically in the foregoing order, and each field in the message has a fixed number of bytes. The message type and data length fields may be comprised of a single header. The data field may include novel groups of OSI TP PDUs where each grouping characterizes the content of the data in the PDU. A novel apparatus for use in a distributed transaction environment also is disclosed. The apparatus may include a peer processing machine and a multiplexed TCP / IP connection for exchanging messages with other peer processing machines in the distributed transaction environment.

Owner:UNISYS CORP

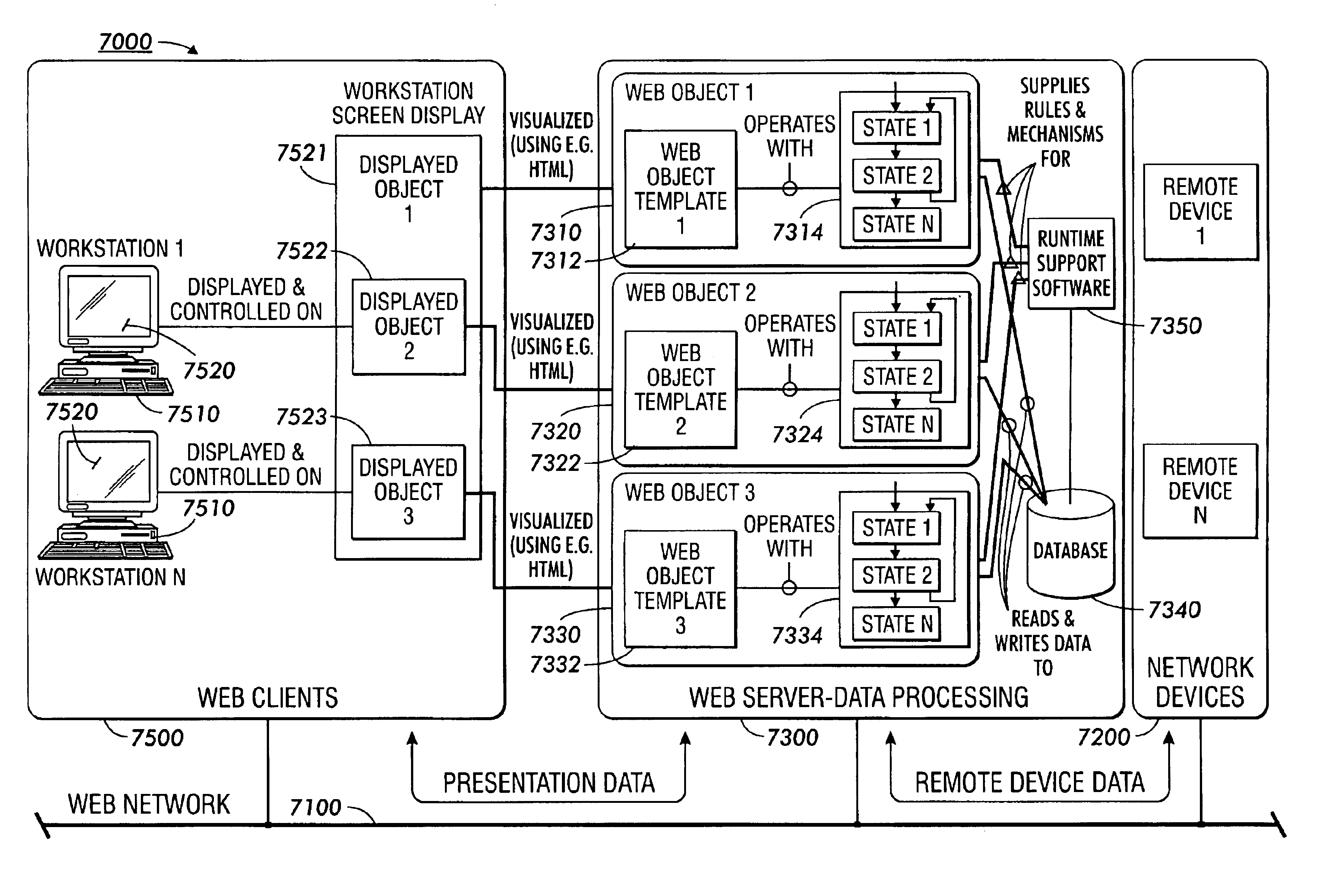

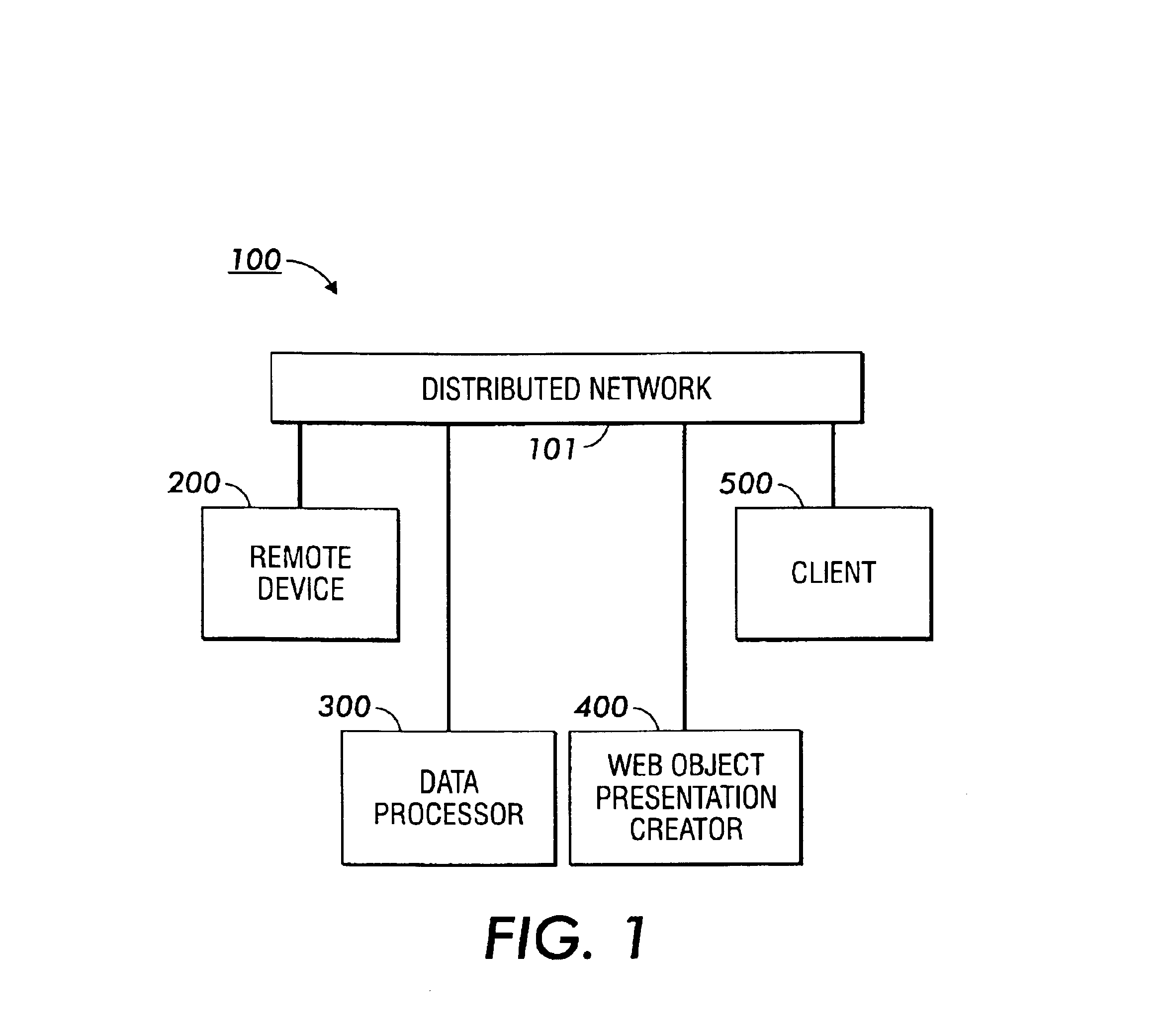

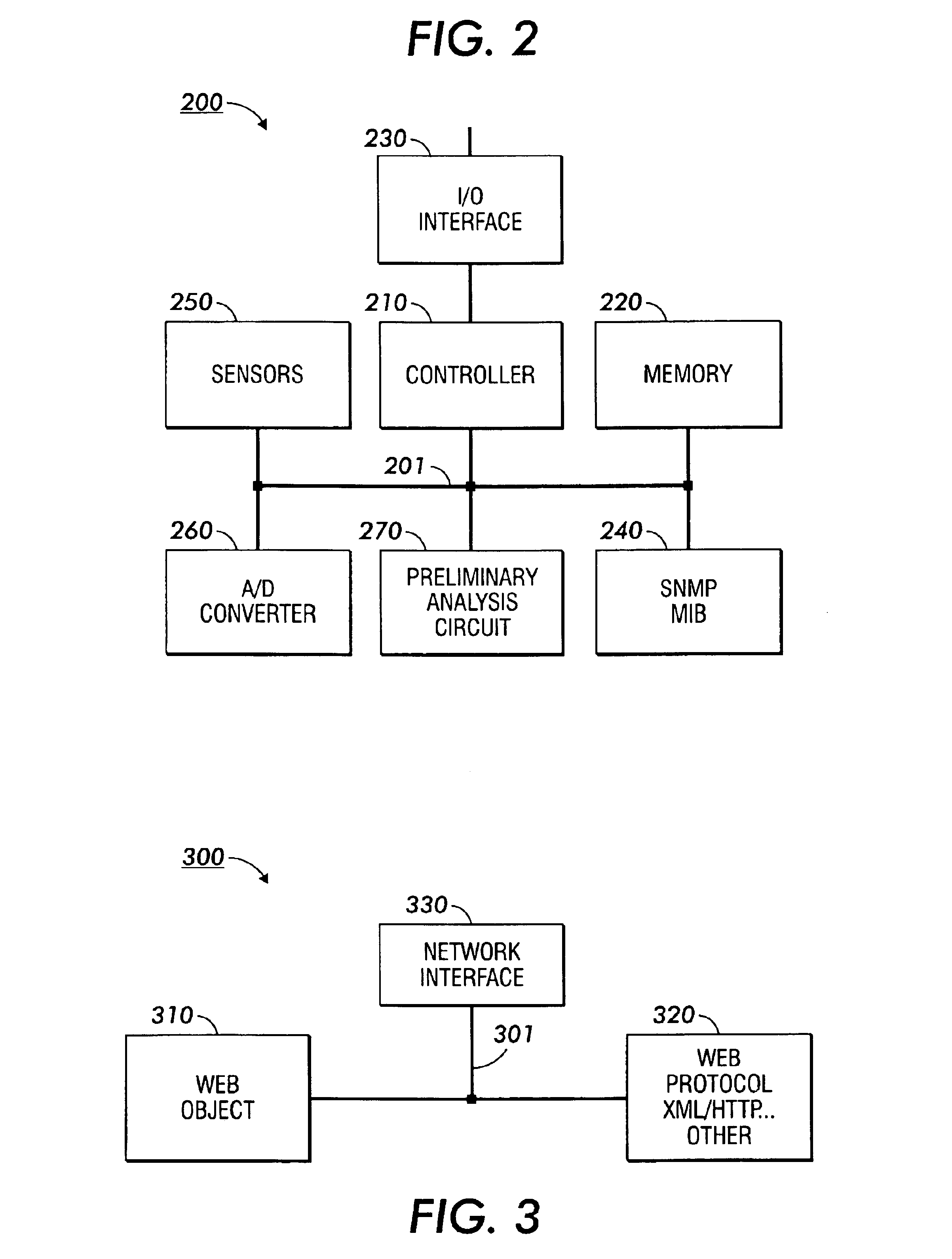

Mechanisms for web-object event/state-driven communication between networked devices

InactiveUS6829630B1Efficient assemblySimplify creationMultiple digital computer combinationsData switching networksProcedural programmingApplication software

Web-based event / state-driven mechanisms and methods for simplifying communication between networked multifunction devices, such as copiers, printers, facsimile machines and multifunction devices using a networked database for the creation and presentation of device metrics and status data. Web-based multifunction performance metrics and calculations themselves are created within concurrent (multiple instances) of Web objects, wherein a Web object is a self-contained entity with data and a state machine lifecycle. State changes inside and outside the Web object are made by sending events to event queues and routing them to other state machines within other Web objects or instances of the same Web object. Data and events between Web objects are formed into a regular event syntax providing a simpler method of communication than those of procedural programming approaches. The arguments of the events are processed by specific instances of state machines that compose each Web object to perform an appropriate action. The metrics displays and corresponding calculations within the Web object's state machine are highly self-contained and concurrent, hiding networked database contention and database locking, and enforcing atomicity with it's runtime software. Calculations are performed and displayed from within a very small context within each Web object's state minimizing external communications and further simplifying software application development efforts.

Owner:MAJANDRO LLC

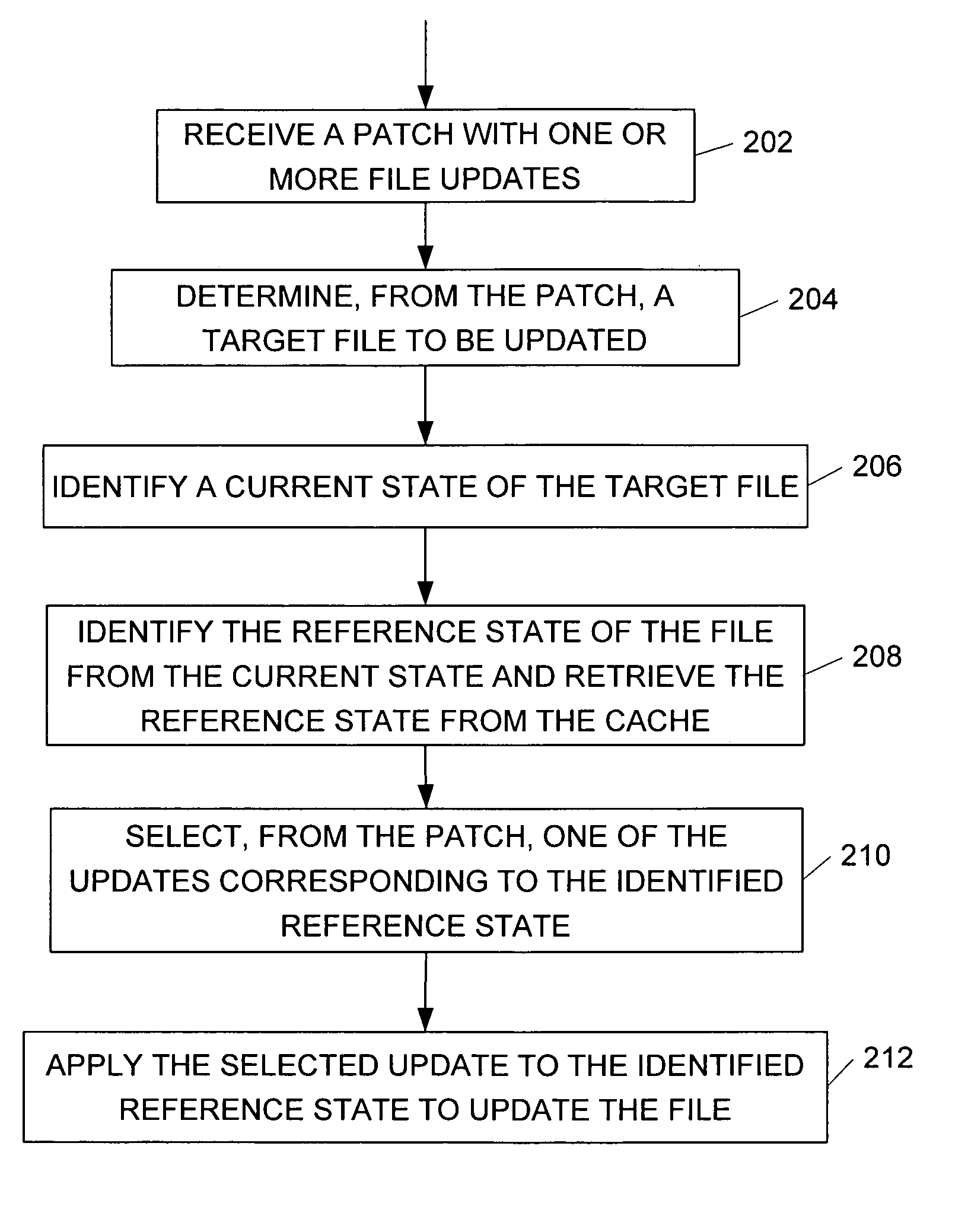

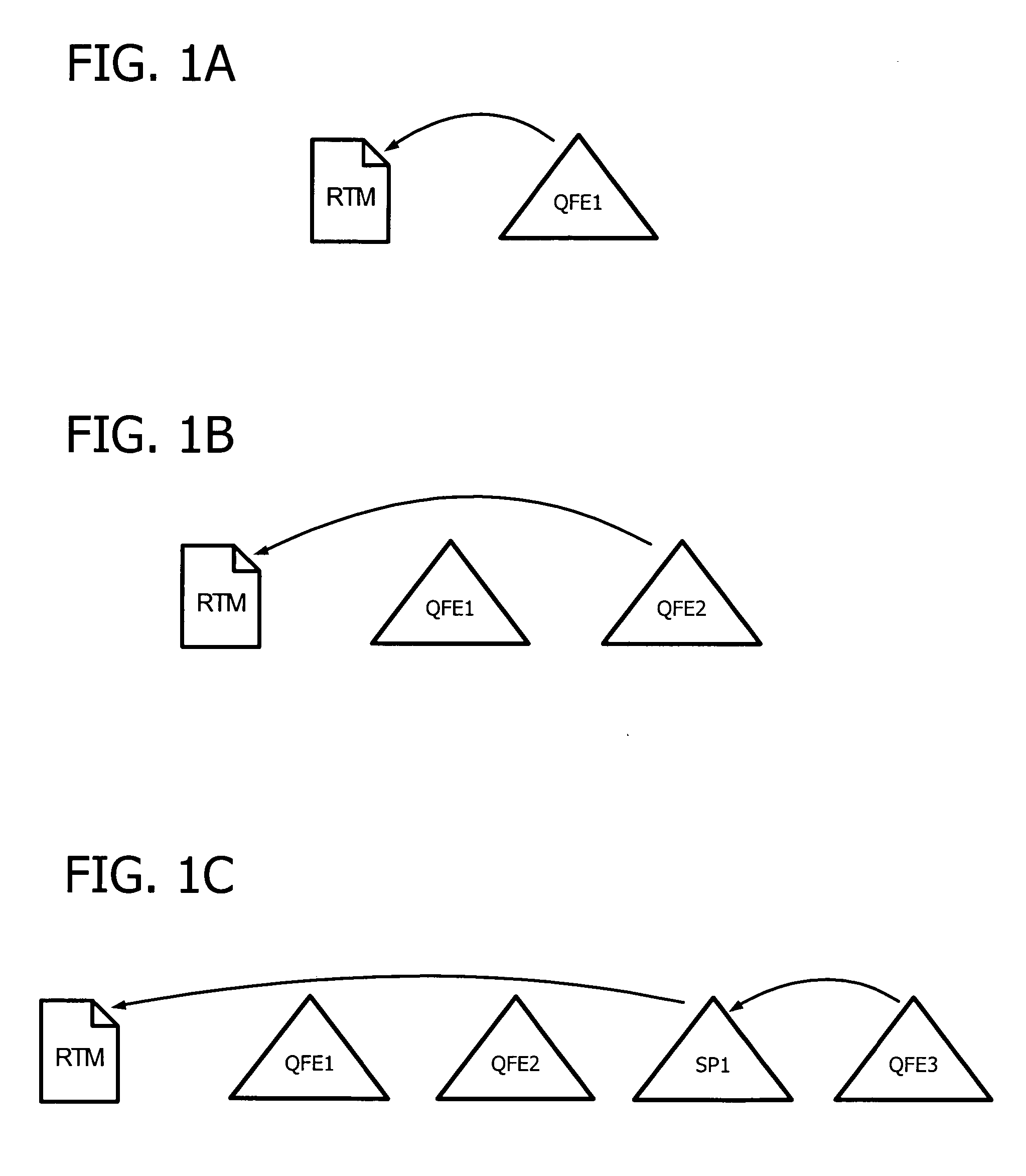

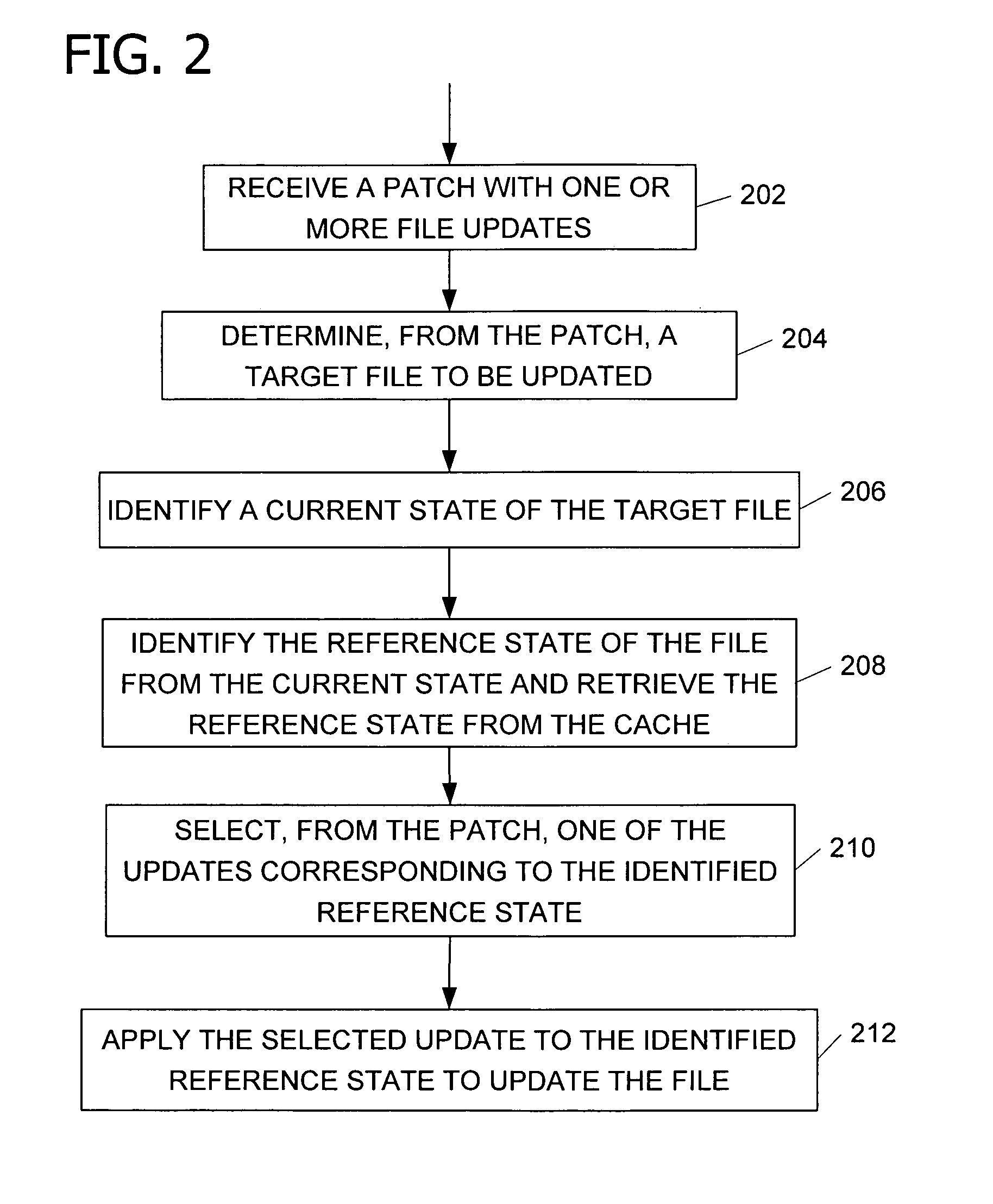

Smart patching by targeting particular prior versions of a file

InactiveUS20060112152A1Small and reliableSmall sizeSoftware engineeringSpecial data processing applicationsHeuristicDatabase

Limiting patch size and complexity through heuristics which use file and product attributes to select a subset of reference file versions (prior states) from the set of all file versions. Patches target this set of reference versions. The computing device stores one or more of the prior states. The current state of the file represents at least one of the prior states with an update applied thereto. The invention selects one of the updates from the patch that corresponds to one of the prior states stored on the computing device. The invention applies the selected update to the corresponding prior state to update the file.

Owner:MICROSOFT TECH LICENSING LLC

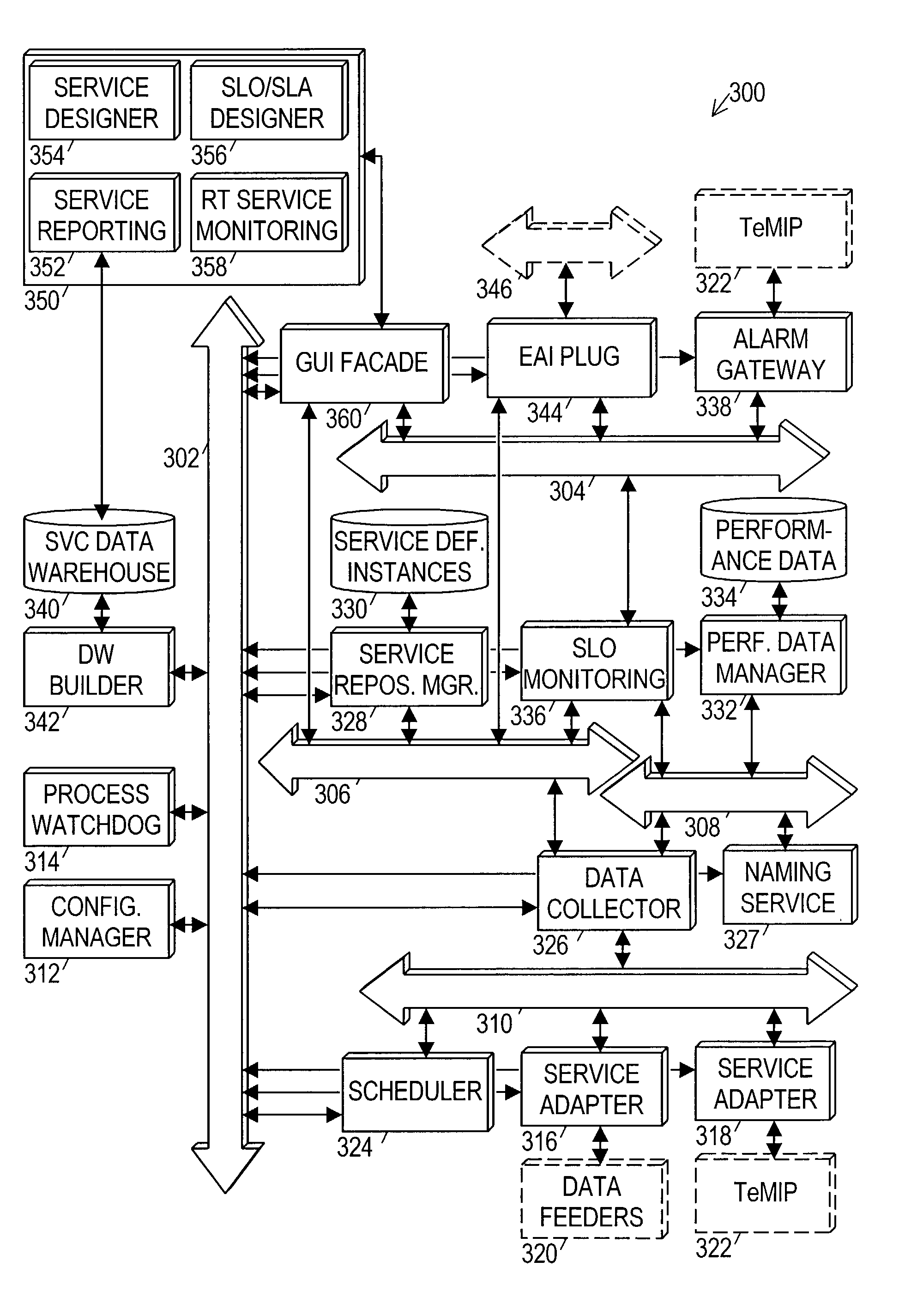

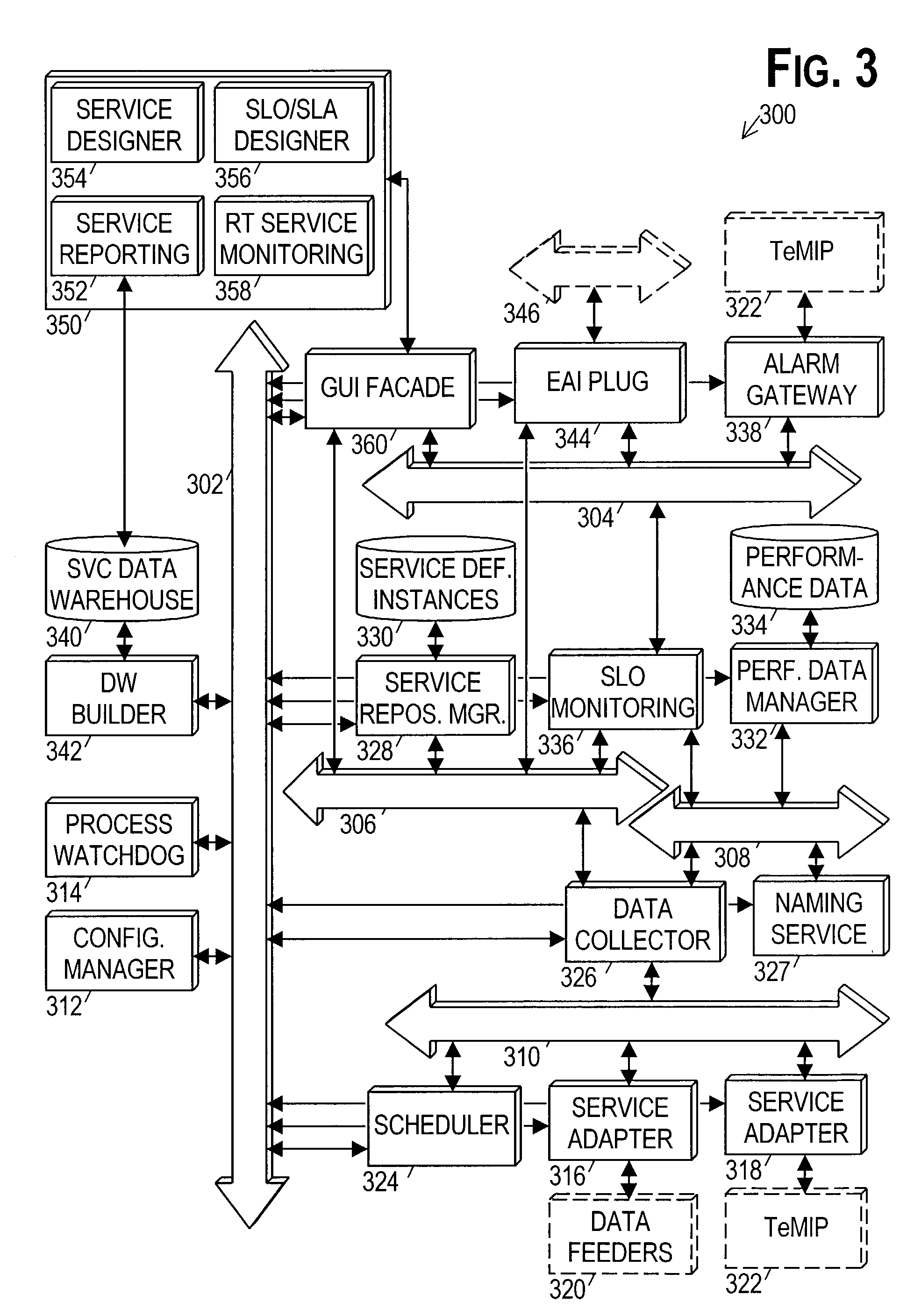

UML representation of parameter calculation expressions for service monitoring

InactiveUS20030212778A1Simplifies editingSimplify creationDigital computer detailsData switching networksAlgorithmSequence diagram

An object-oriented modeling approach is used to represent telecommunication services, parameters and calculation expressions associated with the parameters. Preferably, the Unified Modeling Language ("UML") is used in this regard. Further still, UML "sequence diagrams" are used to represent the calculation expressions as a sequence of UML methods that accomplishes what is required by the expression. The use of UML to represent calculation expressions simplifies editing and creating the expressions and permits a visual representation of the expressions.

Owner:HEWLETT PACKARD DEV CO LP

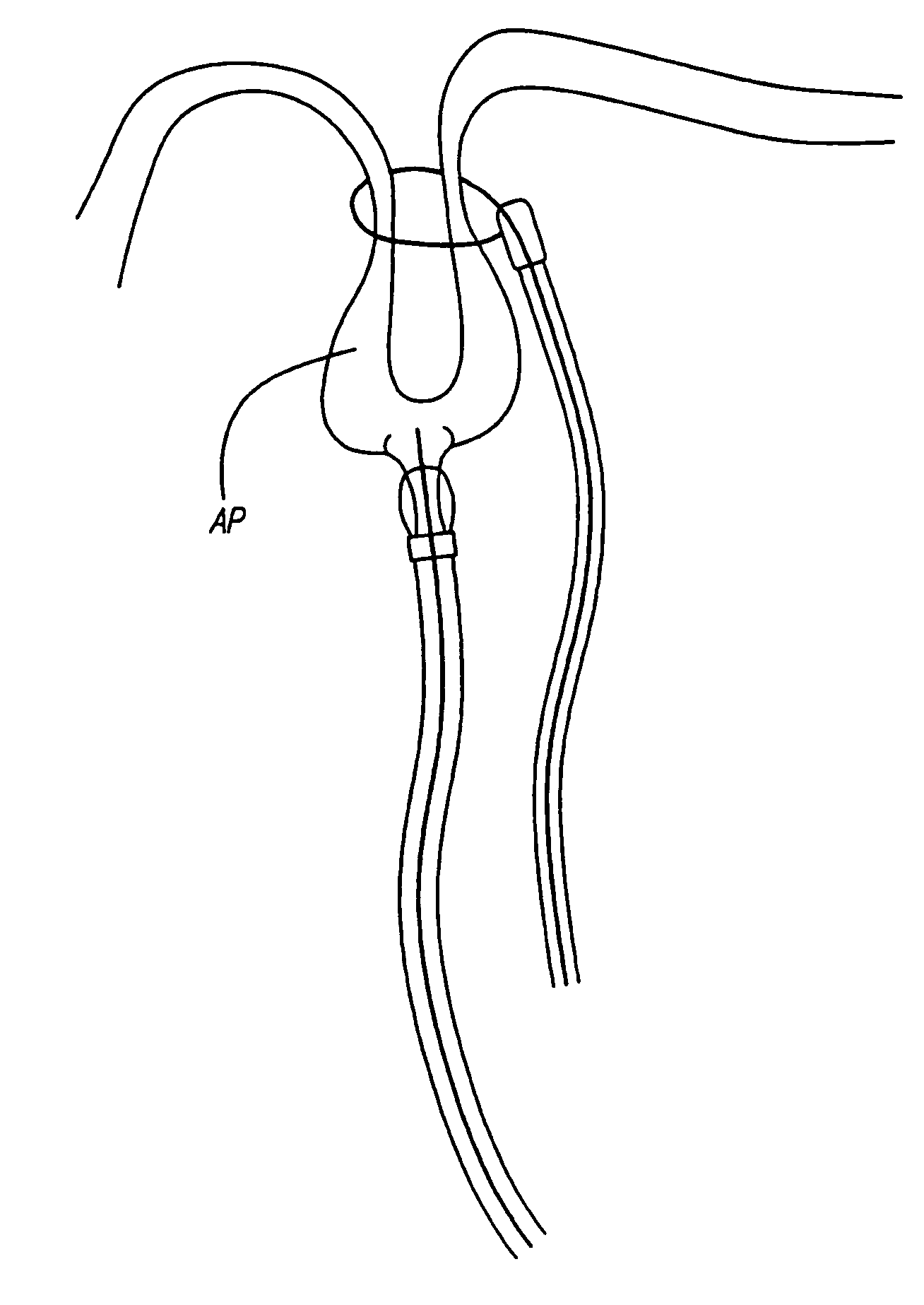

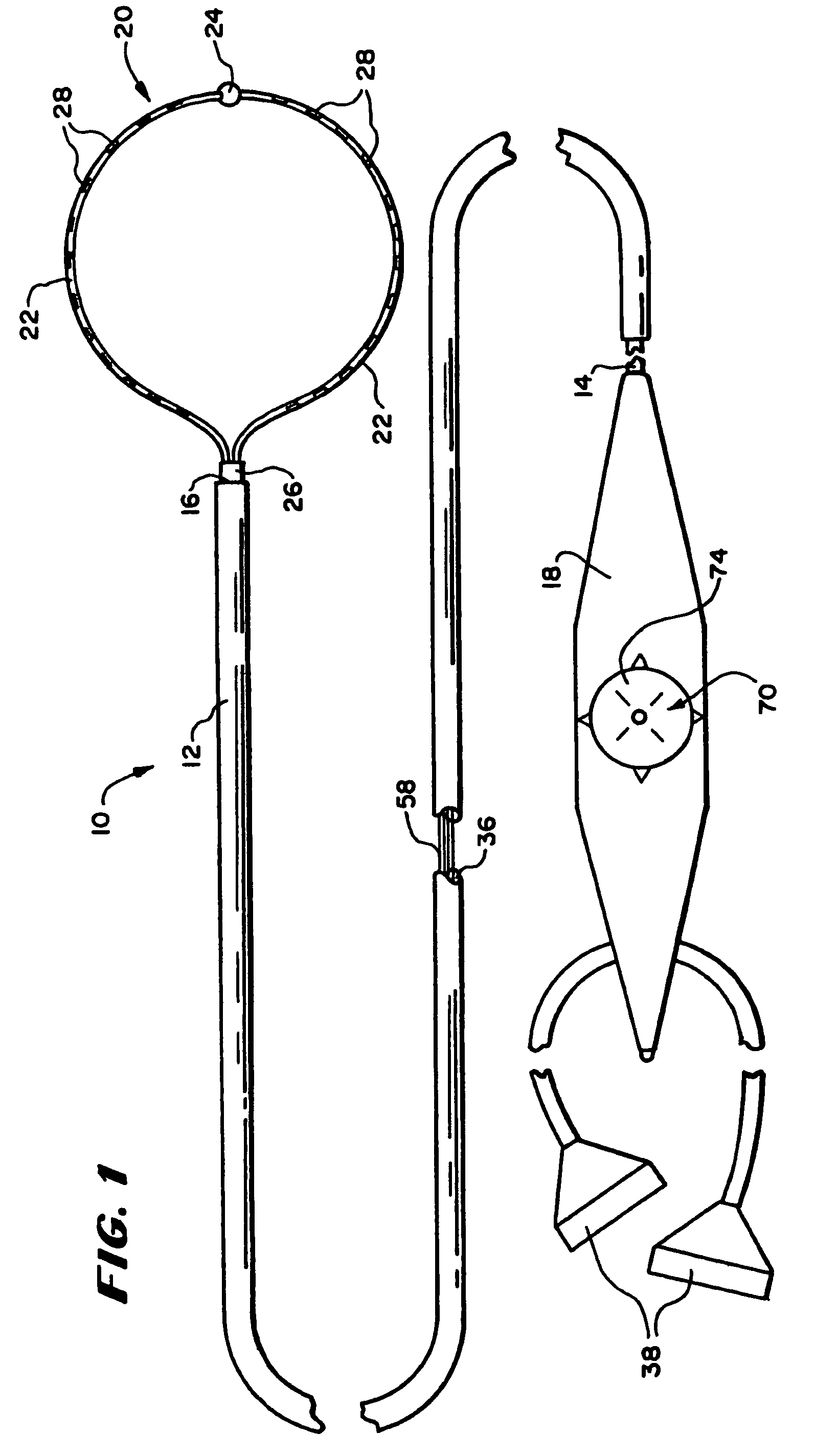

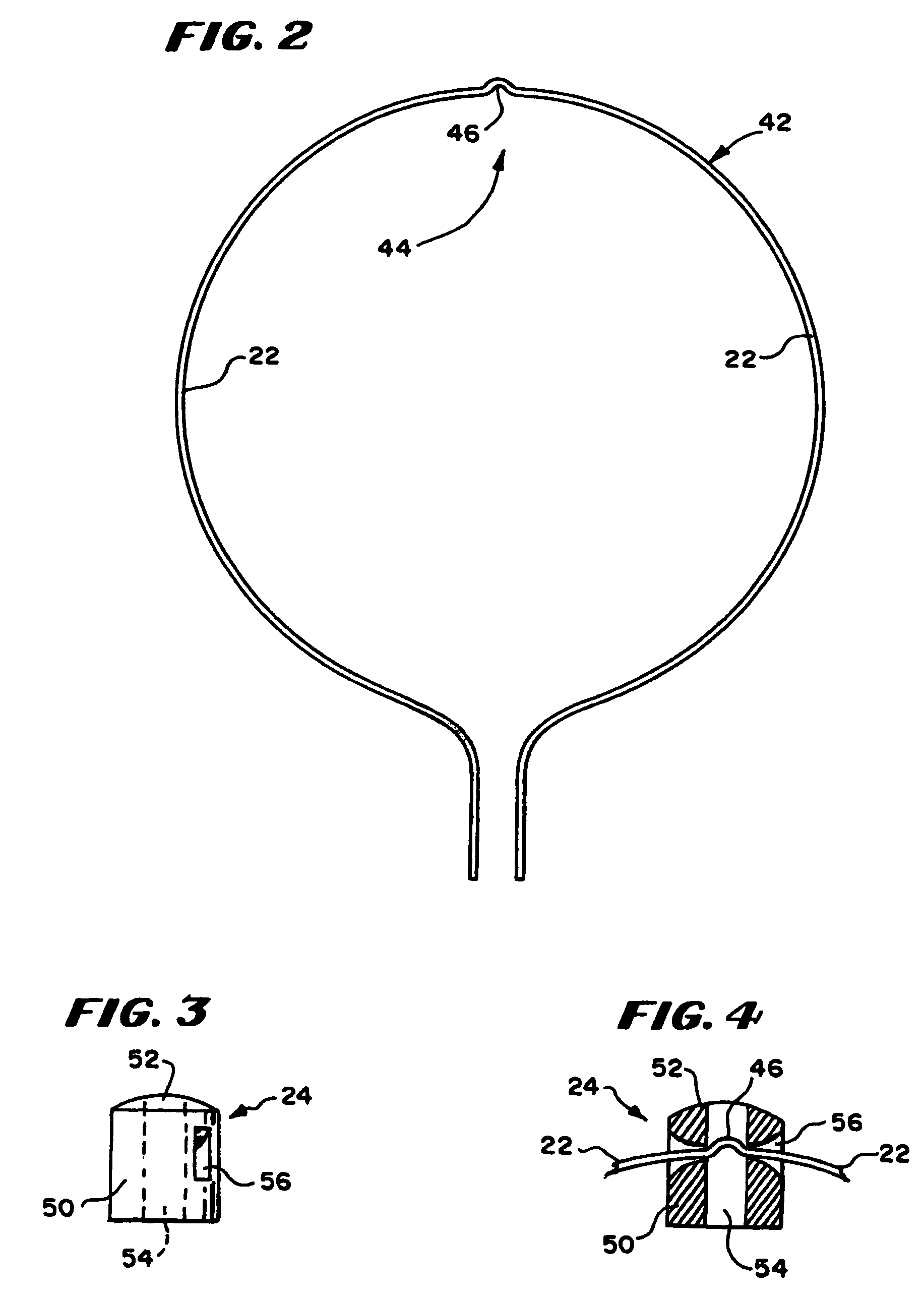

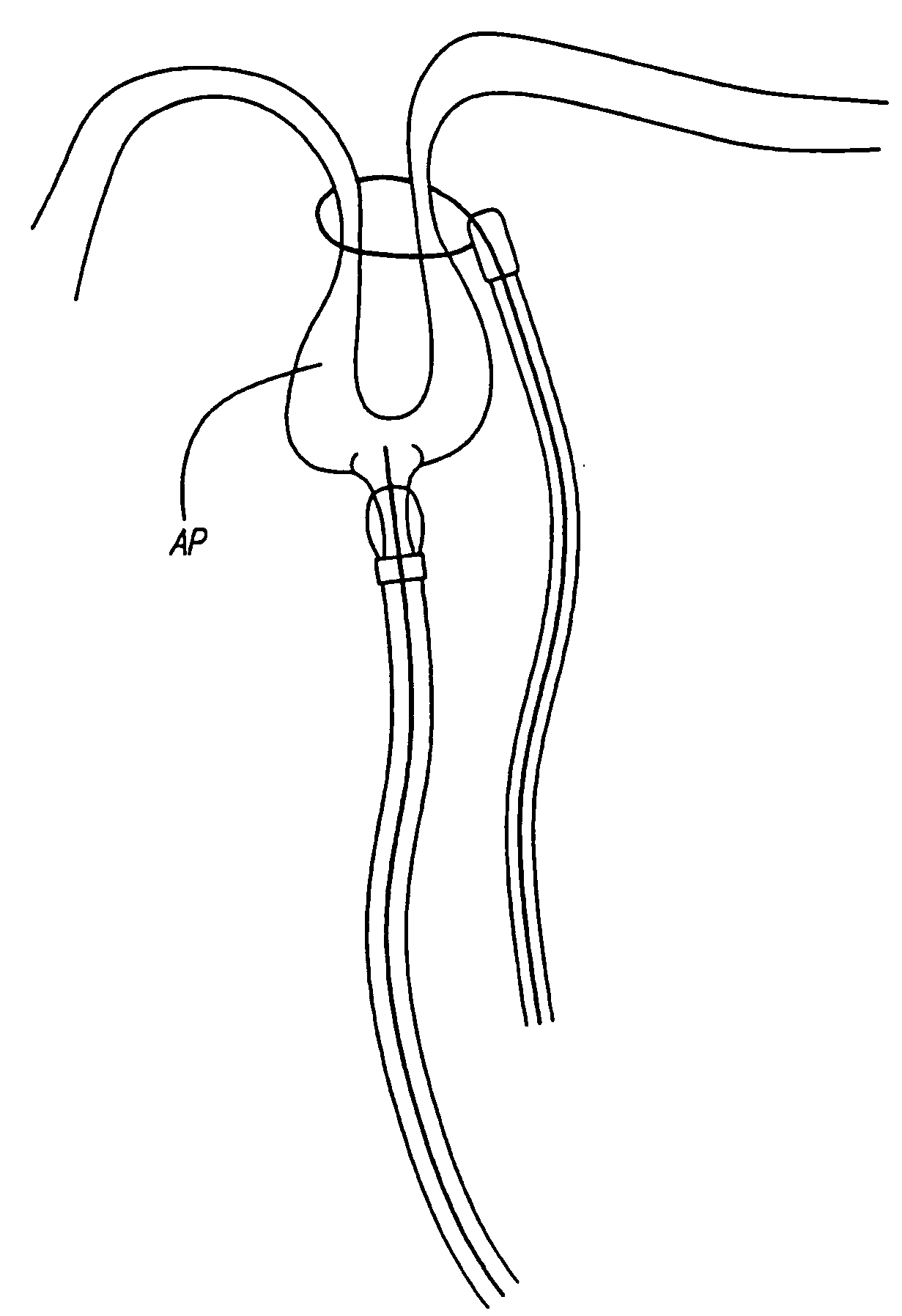

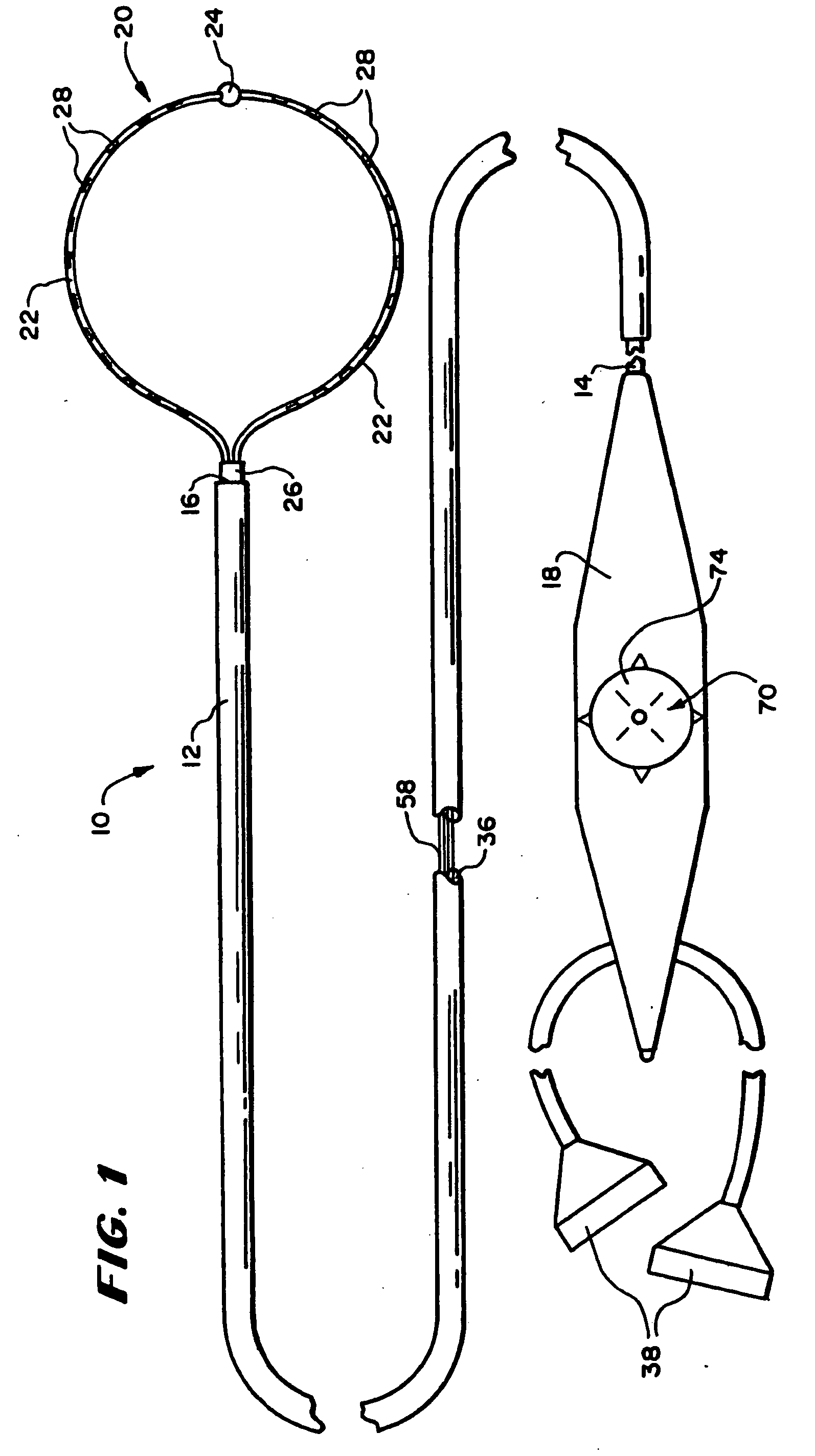

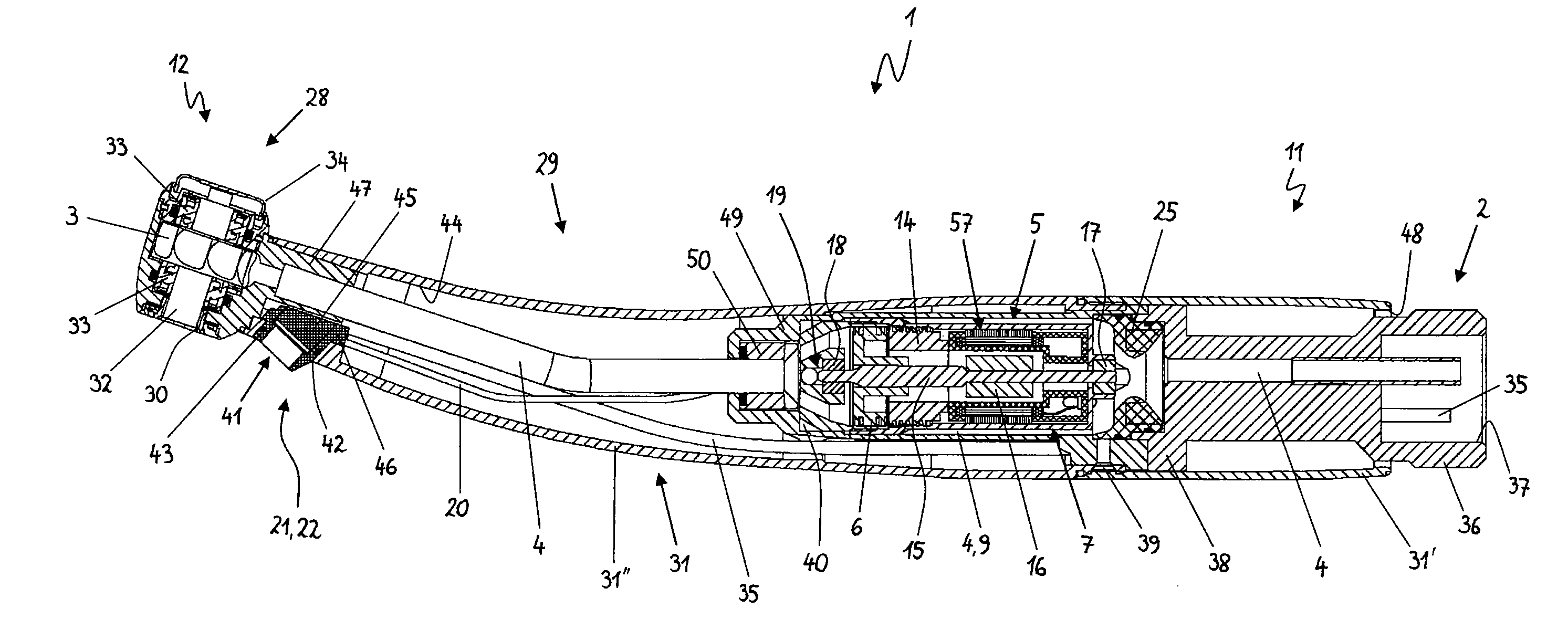

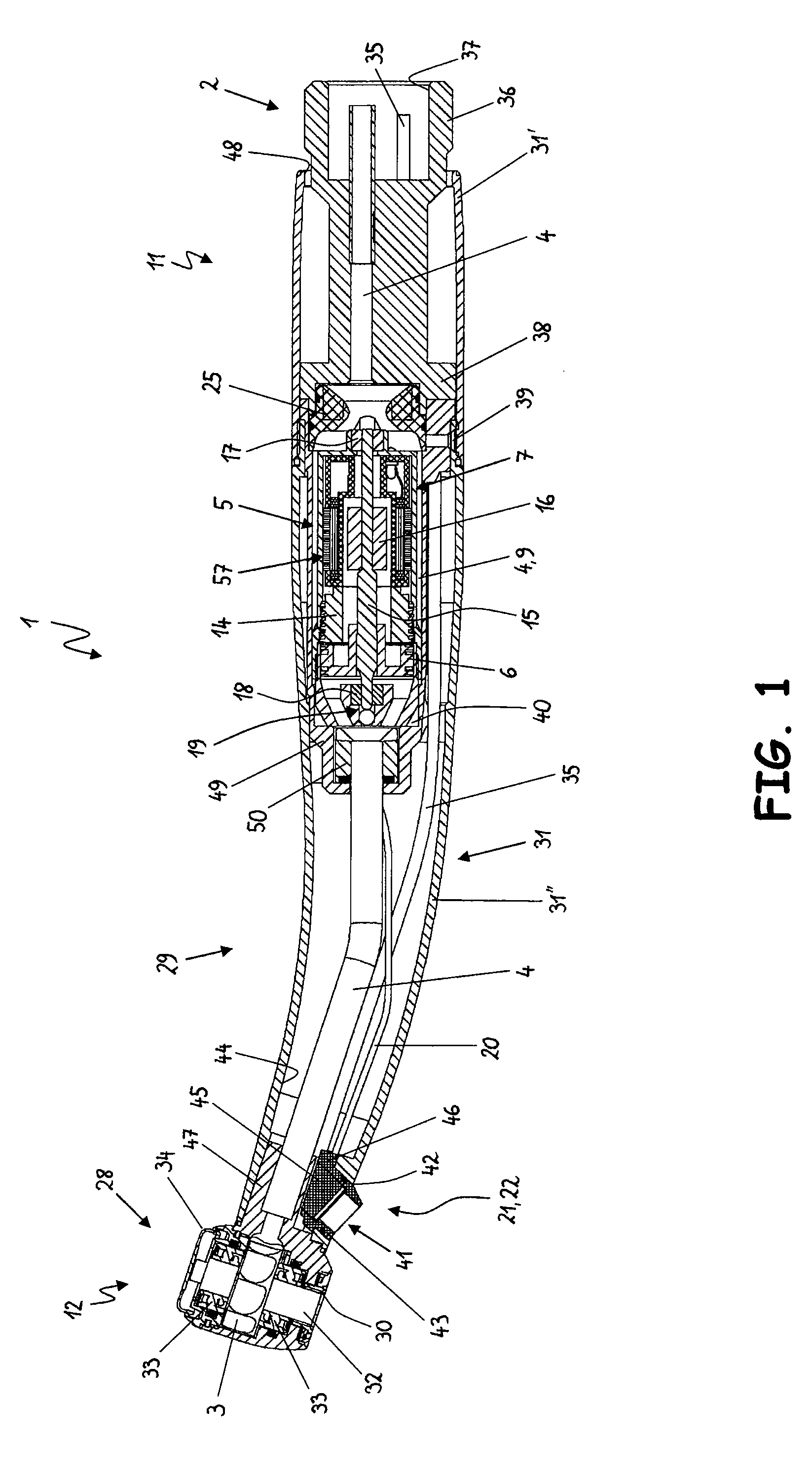

Surgical method and apparatus for positioning a diagnostic or therapeutic element within the body

InactiveUS7052492B2Simplify creationAvoid poor resultsTransvascular endocardial electrodesInstrument handpiecesSurgical methodsCatheter device

Owner:EP TECH

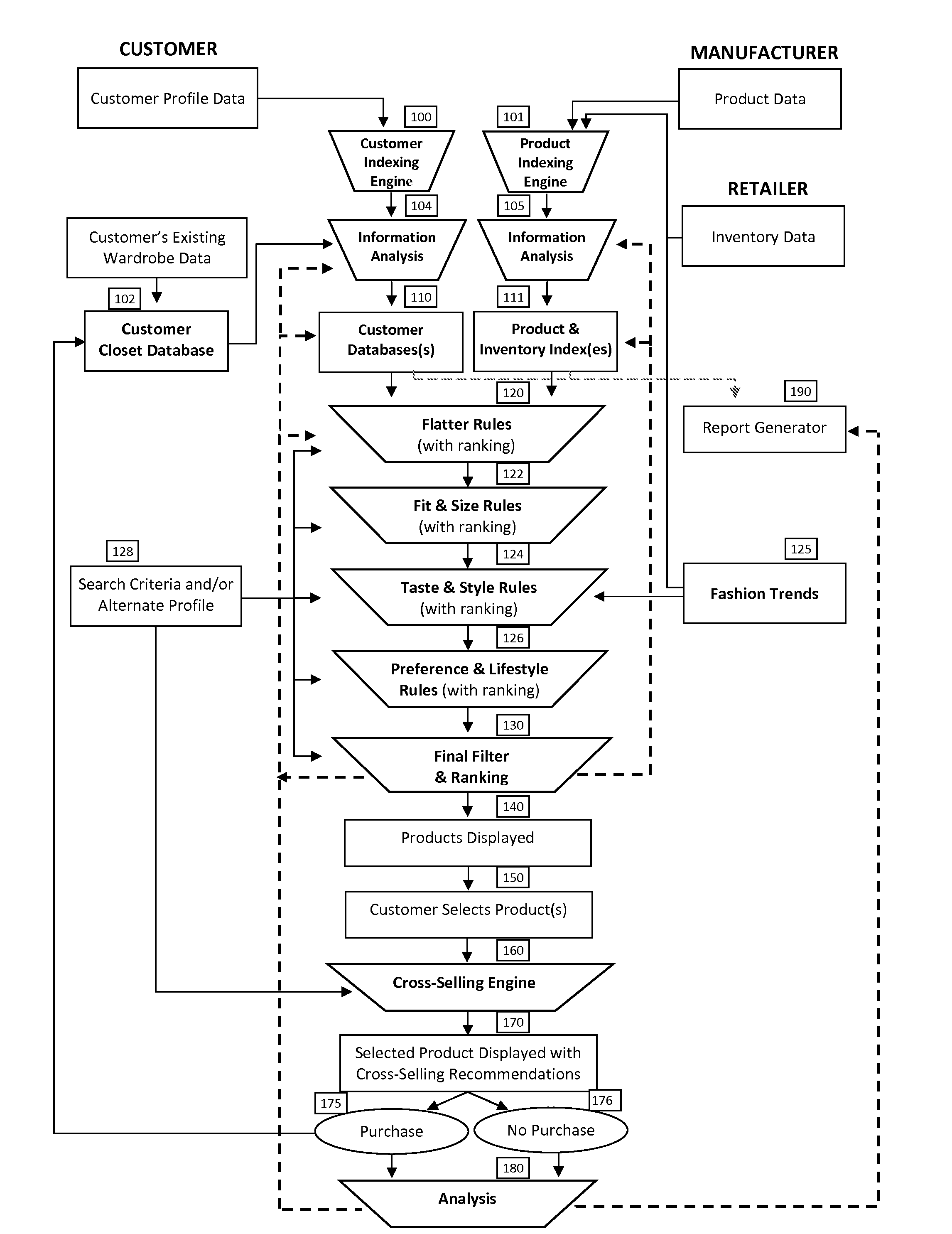

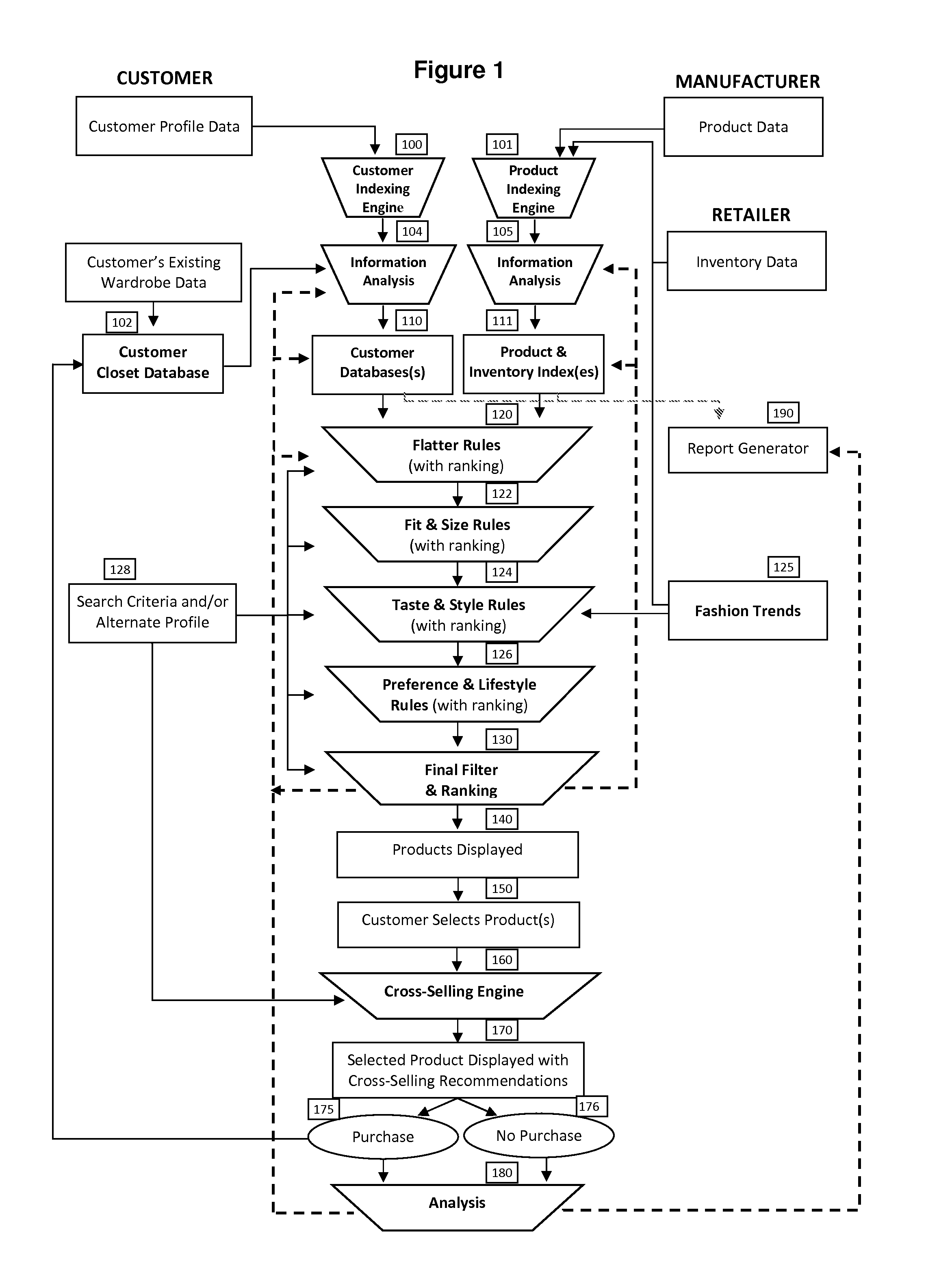

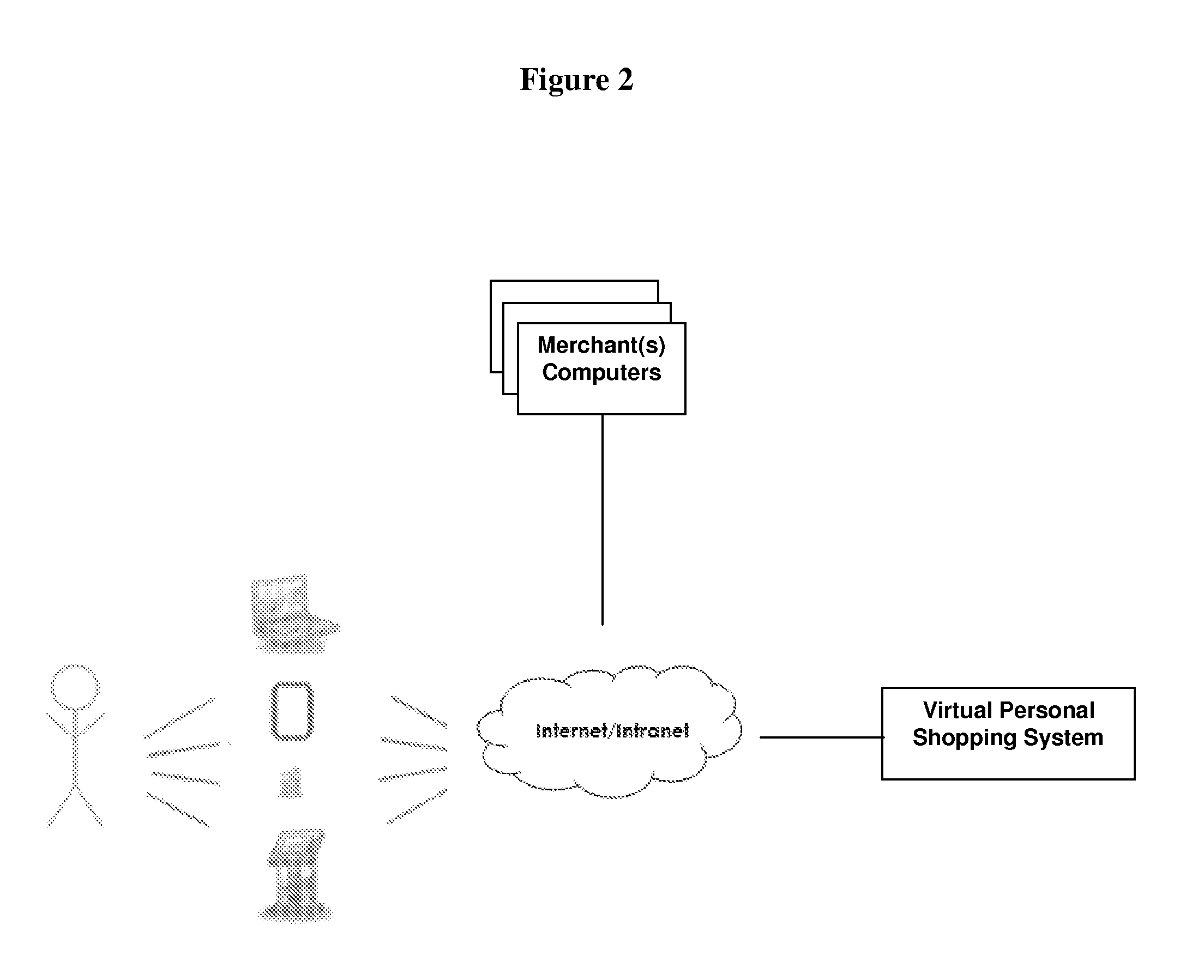

Virtual Personal Shopping System

InactiveUS20140344102A1Significantly increases sales, profit margins and customer loyaltyChoose accuratelyBuying/selling/leasing transactionsComputer scienceAutomated method

The invention relates to selecting products and / or services that meet a customer's needs. In particular, the invention relates to an automated method and system for recommending relevant products and / or services utilizing expert knowledge.

Owner:COOPER CHAYA

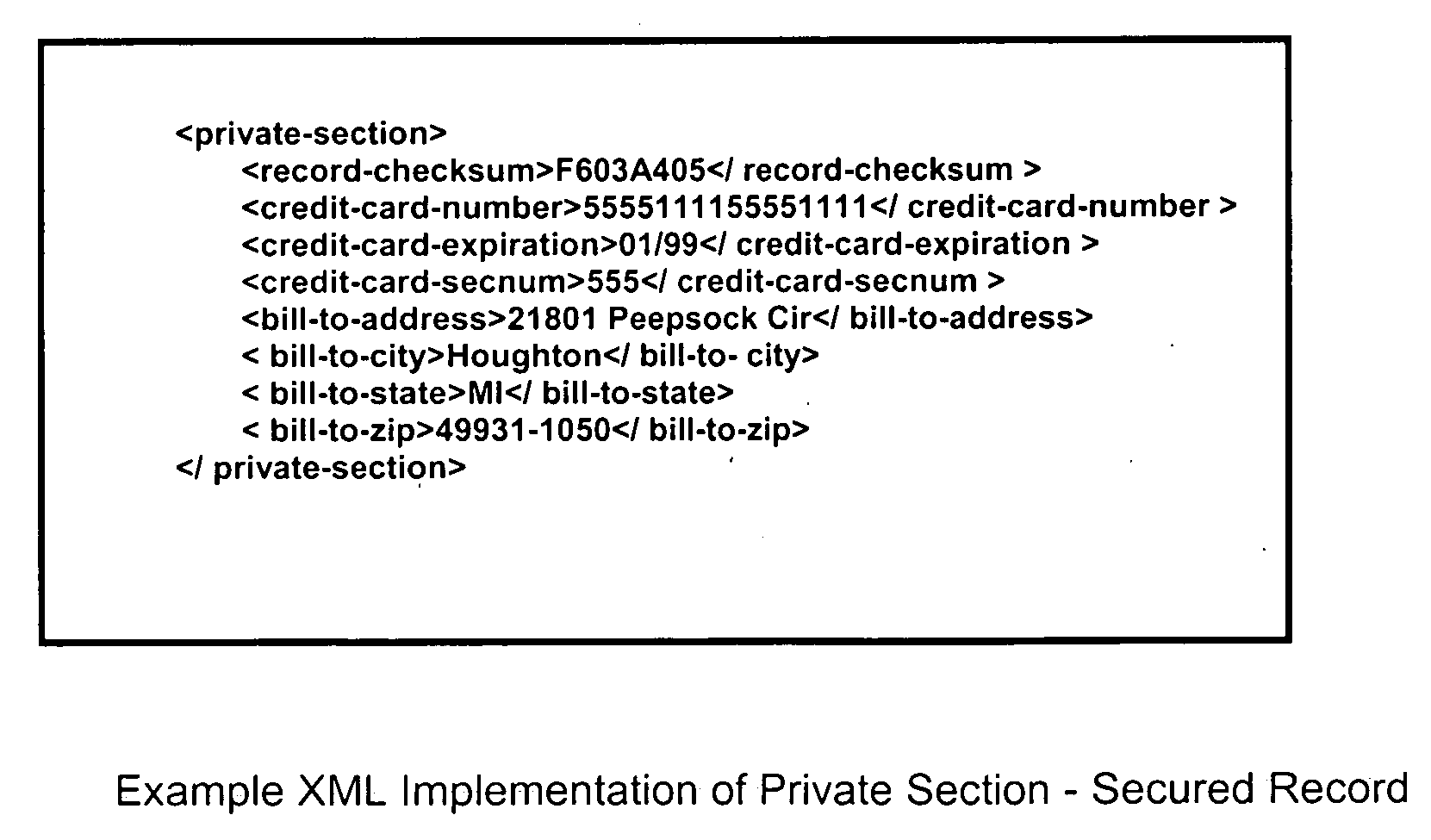

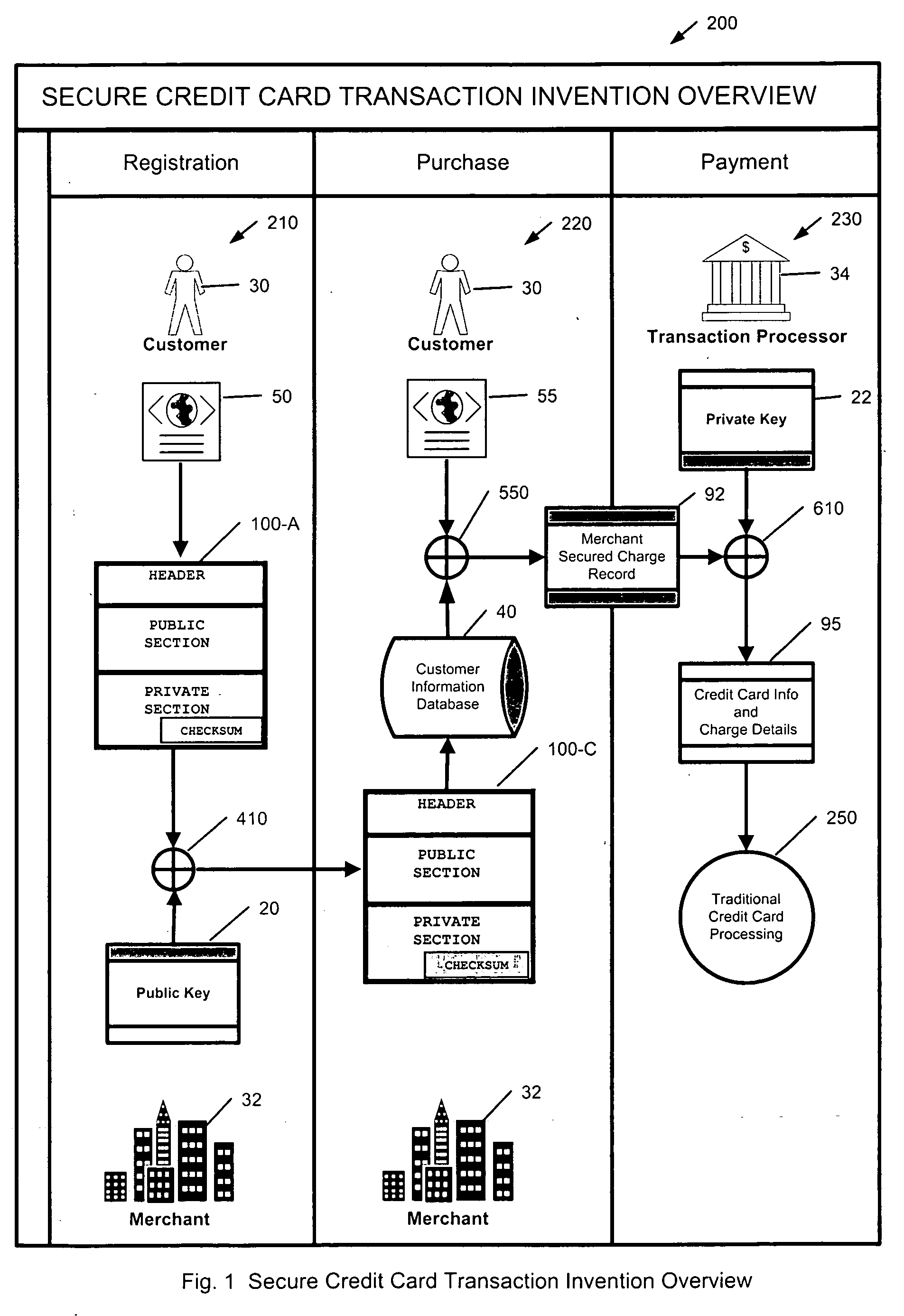

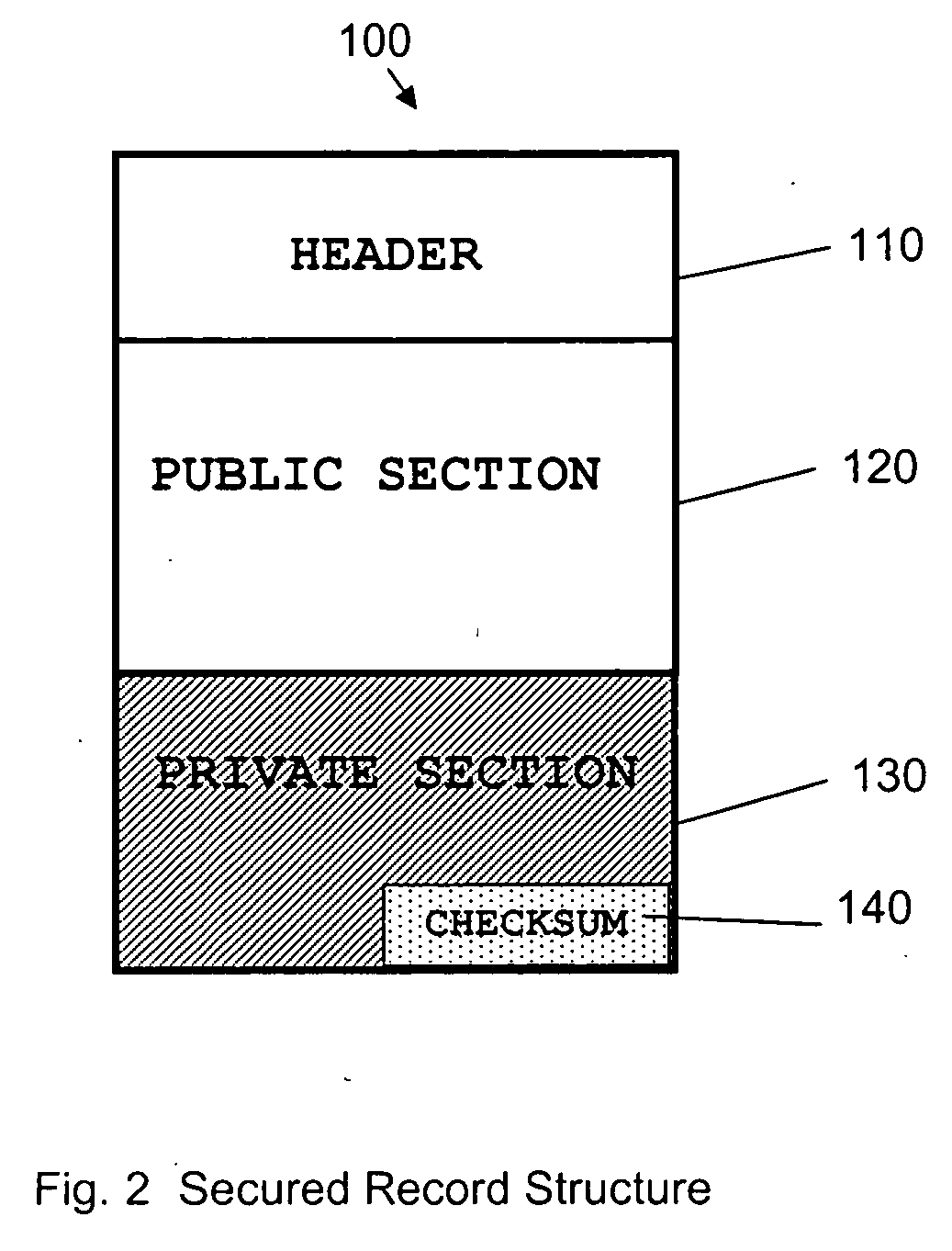

Method to secure credit card information stored electronically

InactiveUS20060282372A1Ensure integrityMinimize expirationAcutation objectsFinanceCredit cardChecksum

A method by which merchants who store sensitive credit card information can secure the information from theft, while minimizing the impact on the customer, as well as minimizing the cost of implementation. The merchant uses a special secured record for the storage of the credit card information for a specific customer. The record consists of two parts. The first part of the record contains public information which is visible to anyone with access to the record. The public information includes the merchant identity, along with information that constrains the use of the record, such as limits on the type of purchase, amount of purchase, or frequency of purchase, as well as the expiration date of the record, approved shipping addresses, and other constraints that make the record effectively useless to anyone except the merchant who created and stored the record, as well as limiting possible abuse by said merchant. The second part of the record contains private information which is encrypted so as to be visible only to parties authorized to view the information. The private part of the record will contain the sensitive credit card information, along with a checksum of the contents of the record. When the record is submitted to the clearing entity, the private part of the record is decrypted using the appropriate key. The checksum is used to verify that the record has not been modified, and that the public and private sections correspond to each other. Once the record is validated, constraints are applied, and if met, the credit card information is used to process the transaction.

Owner:ENDRES TIMOTHY GERARD +1

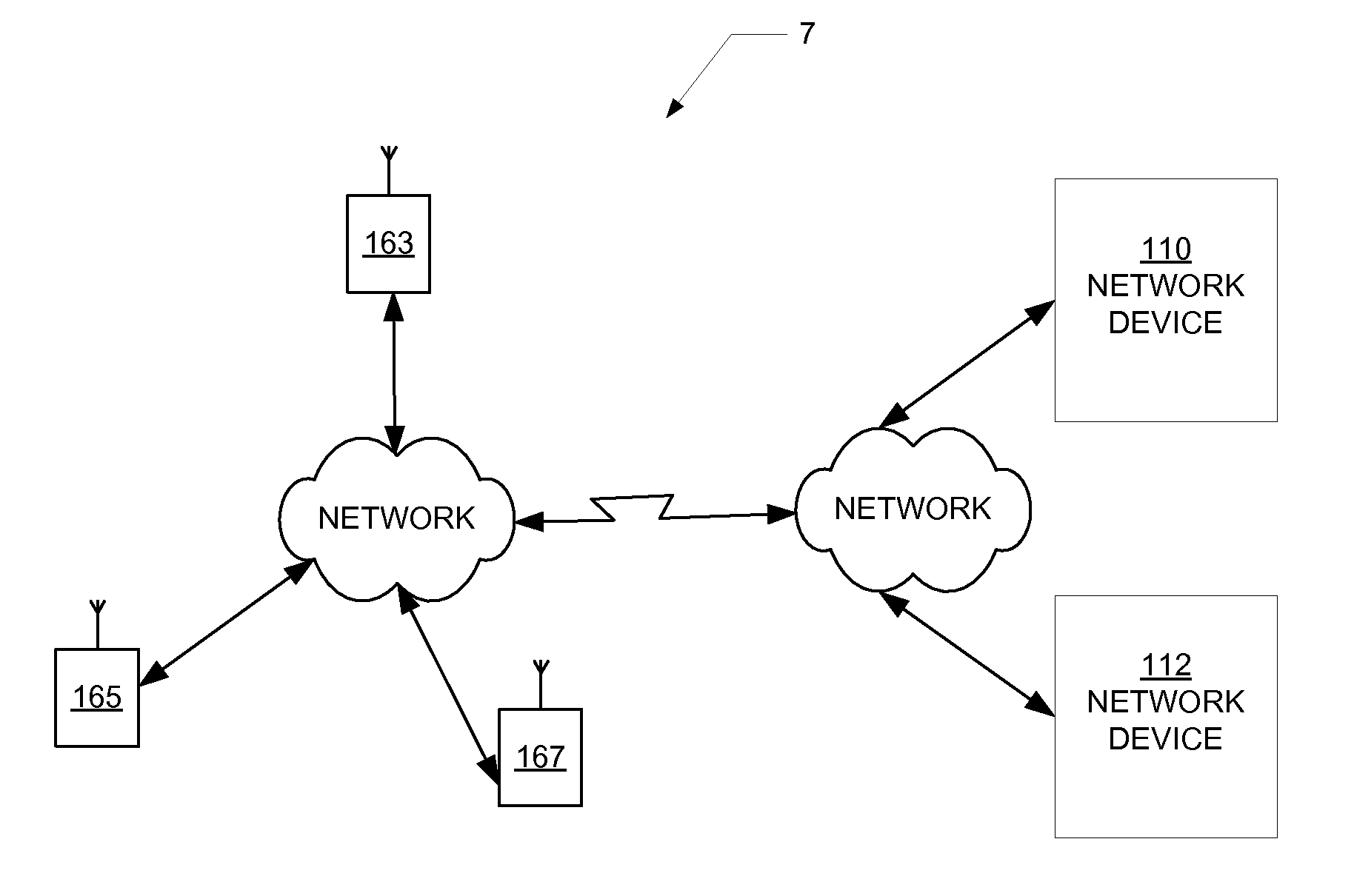

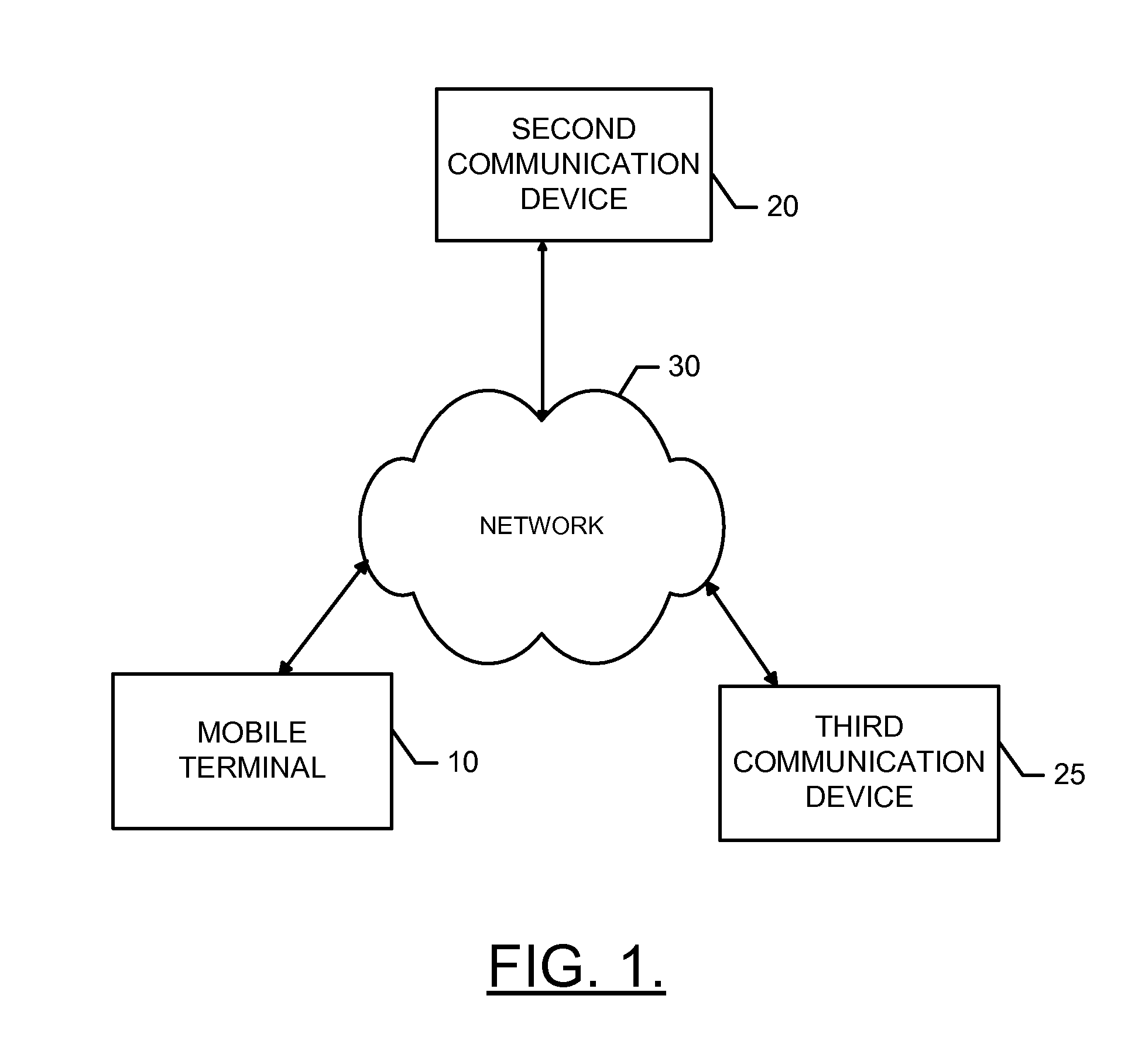

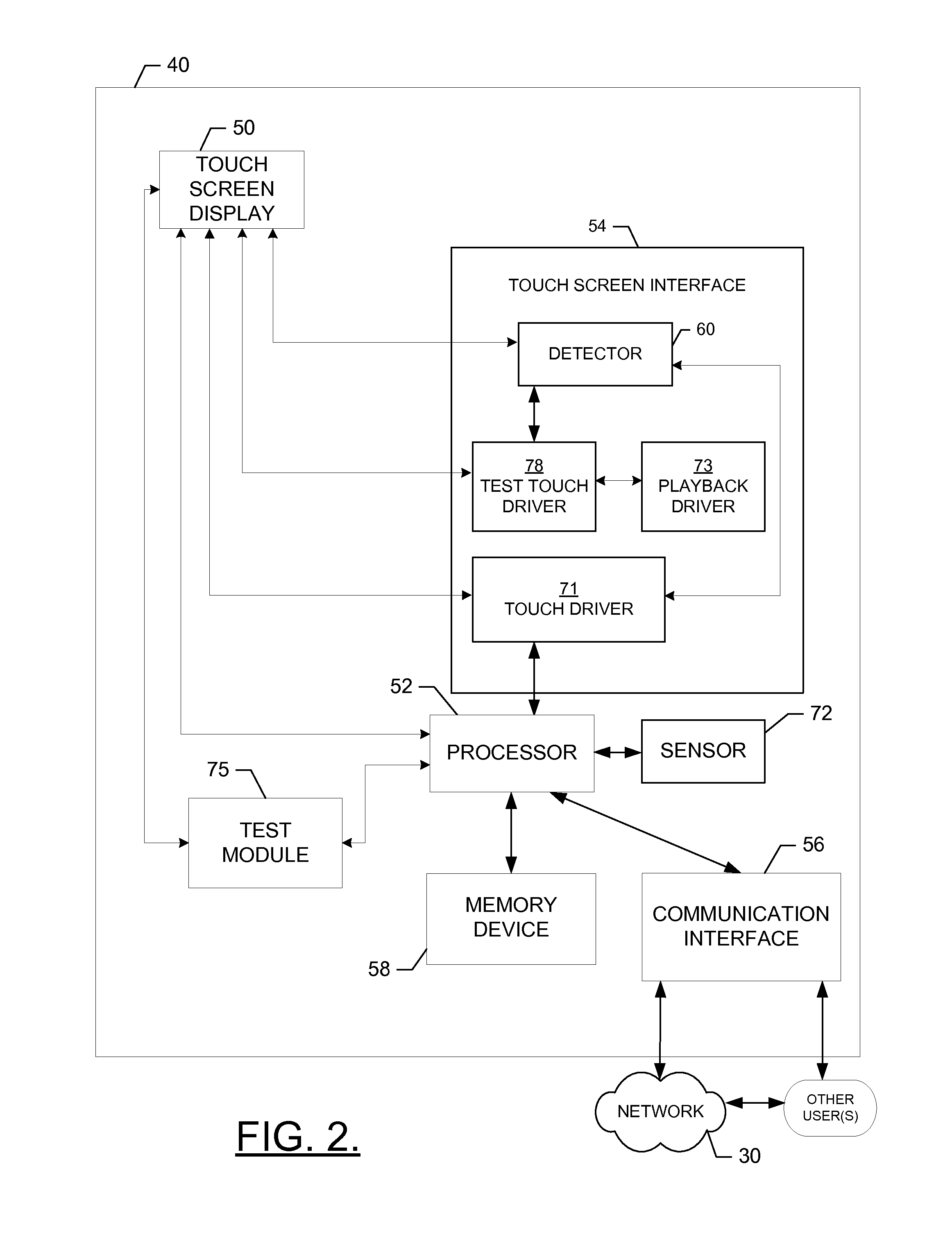

Methods, apparatuses and computer program products for automating testing of devices

ActiveUS20140045483A1Efficient and reliableFacilitates automated testingServices signallingSubstation equipmentAutomatic test equipmentComputer science

An apparatus for facilitating automated testing of one or more communication devices may include a processor and memory storing executable computer code causing the apparatus to at least perform operations including capturing one or more recorded sequences of events in which at least one of the events corresponds to a detection of a touch input. The recorded sequences correspond to at least one designated test. The computer program code may further cause the apparatus to enable provision of the recorded sequences of events to one or more communication devices. The computer program code may further cause the apparatus to facilitate sending of one or more generated commands to at least one of the communication devices instructing the communication device to perform the recorded sequences. Corresponding methods and computer program products are also provided.

Owner:NOKIA TECHNOLOGLES OY

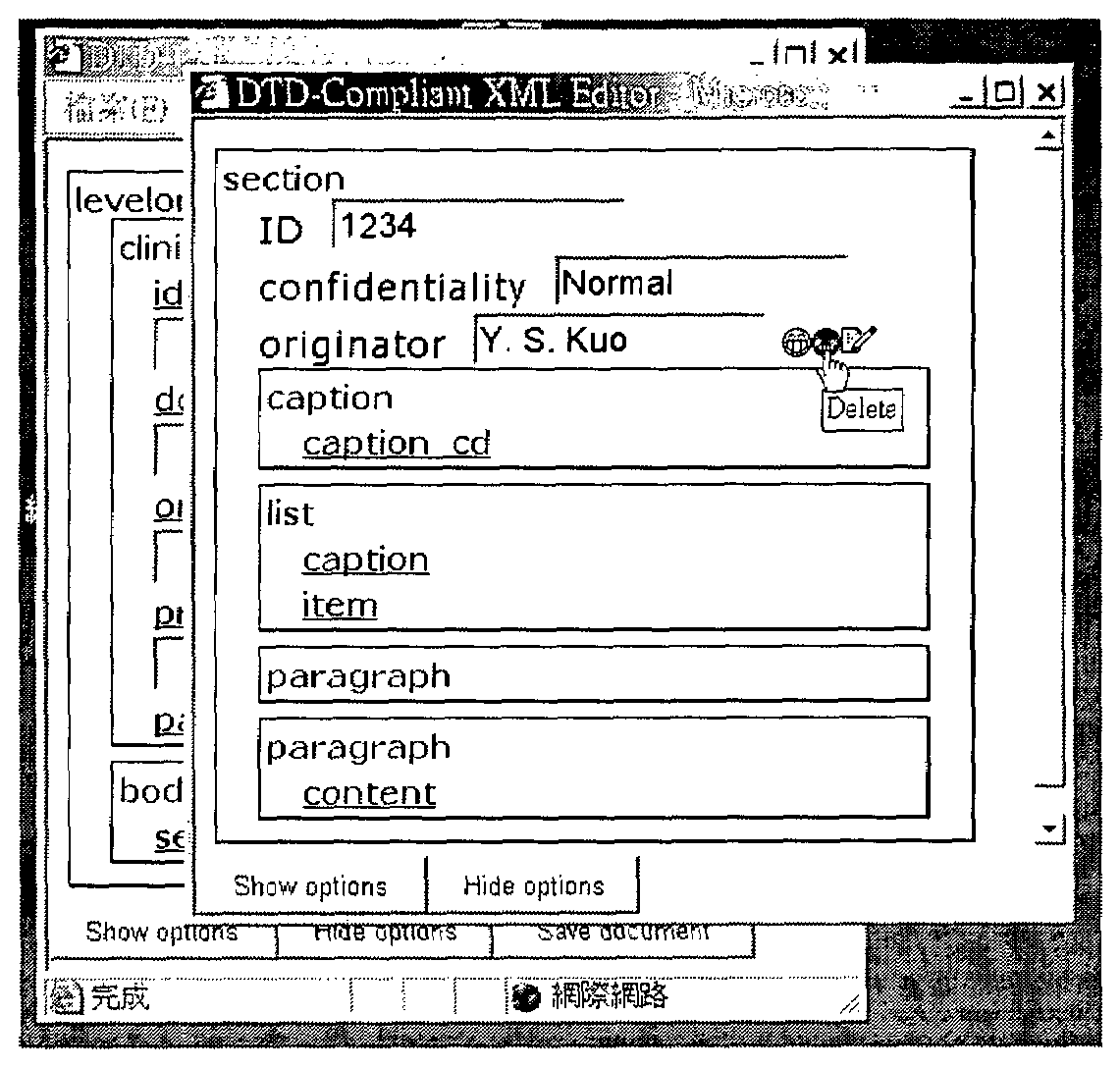

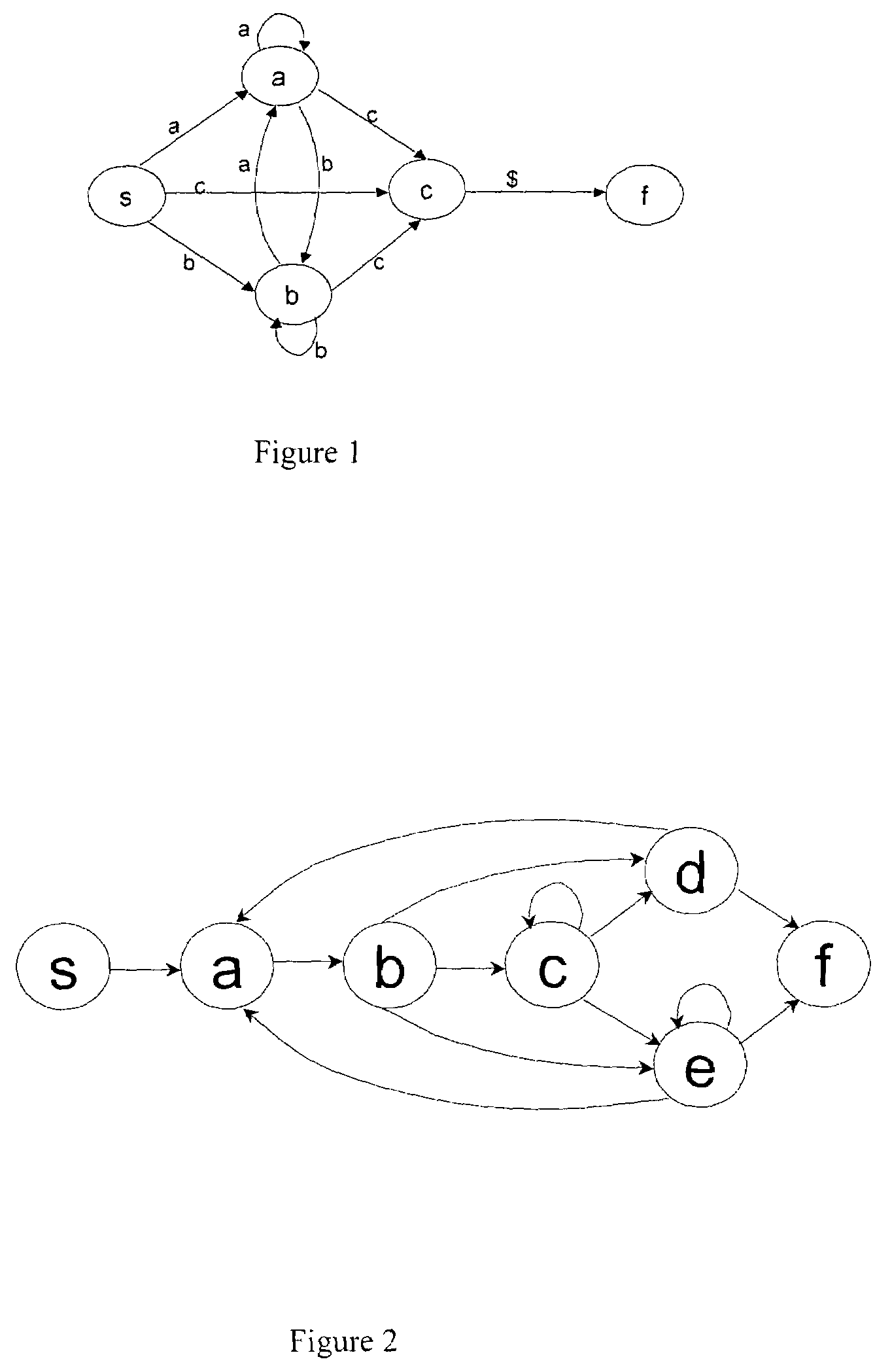

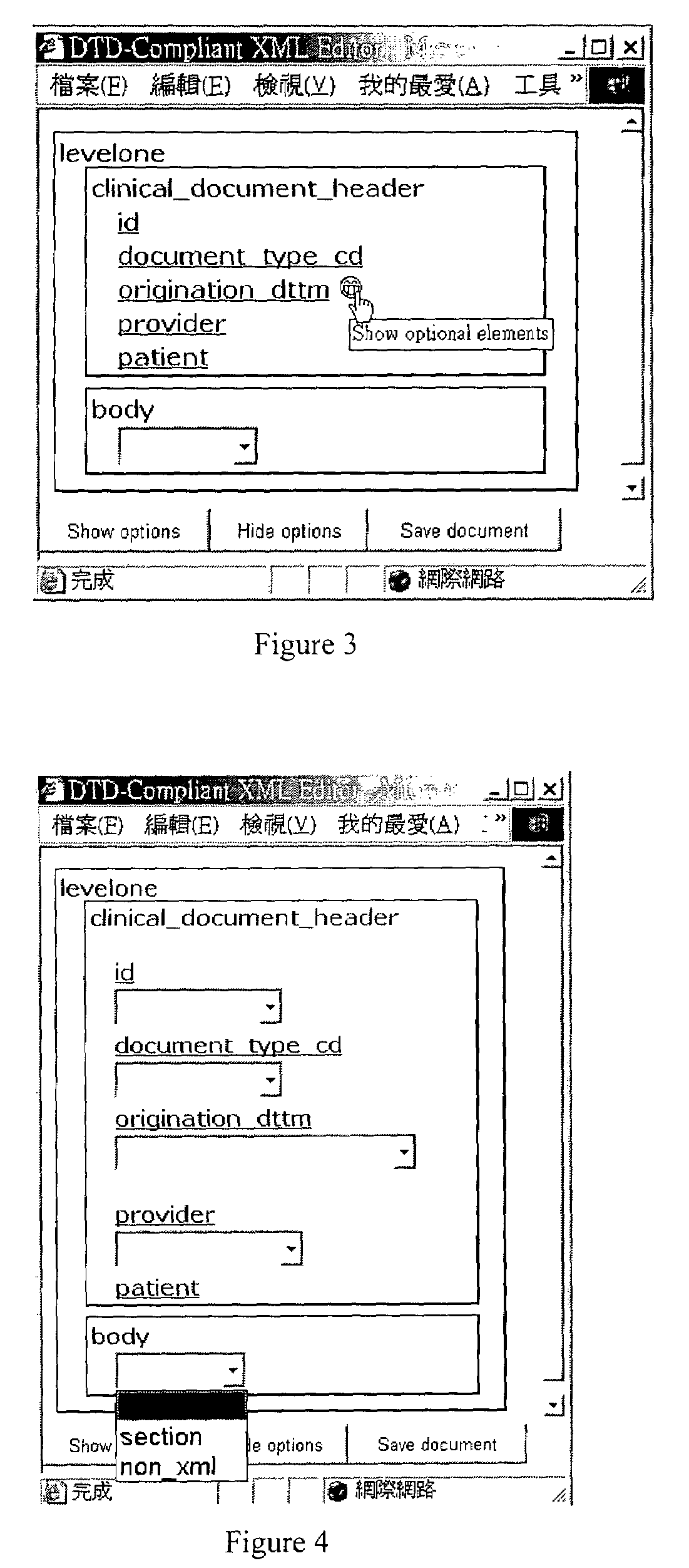

XML document editor

InactiveUS7409673B2Avoid violationsSimplify creationNatural language data processingIntelligent editorsLiving documentDocument preparation

A DTD-compliant XML document editor is disclosed. The XML document editor generates hints for required elements and required element slots automatically in the process of document creation and edition so as to guide the user to produce a valid document, while syntactic violations are avoided at the same time. The editor also suggests optional elements that may be added into the document to be edited. The user requires no knowledge about XML and DTD to edit DTD-compliant XML documents. The editing process is user-interface-neutral, being able to support user interfaces based on tree views, presentation views and forms. By combining the DTD-compliant editing process with the simplicity of forms, a simple XML document editor with forms as its user interface is developed.

Owner:ACAD SINIC

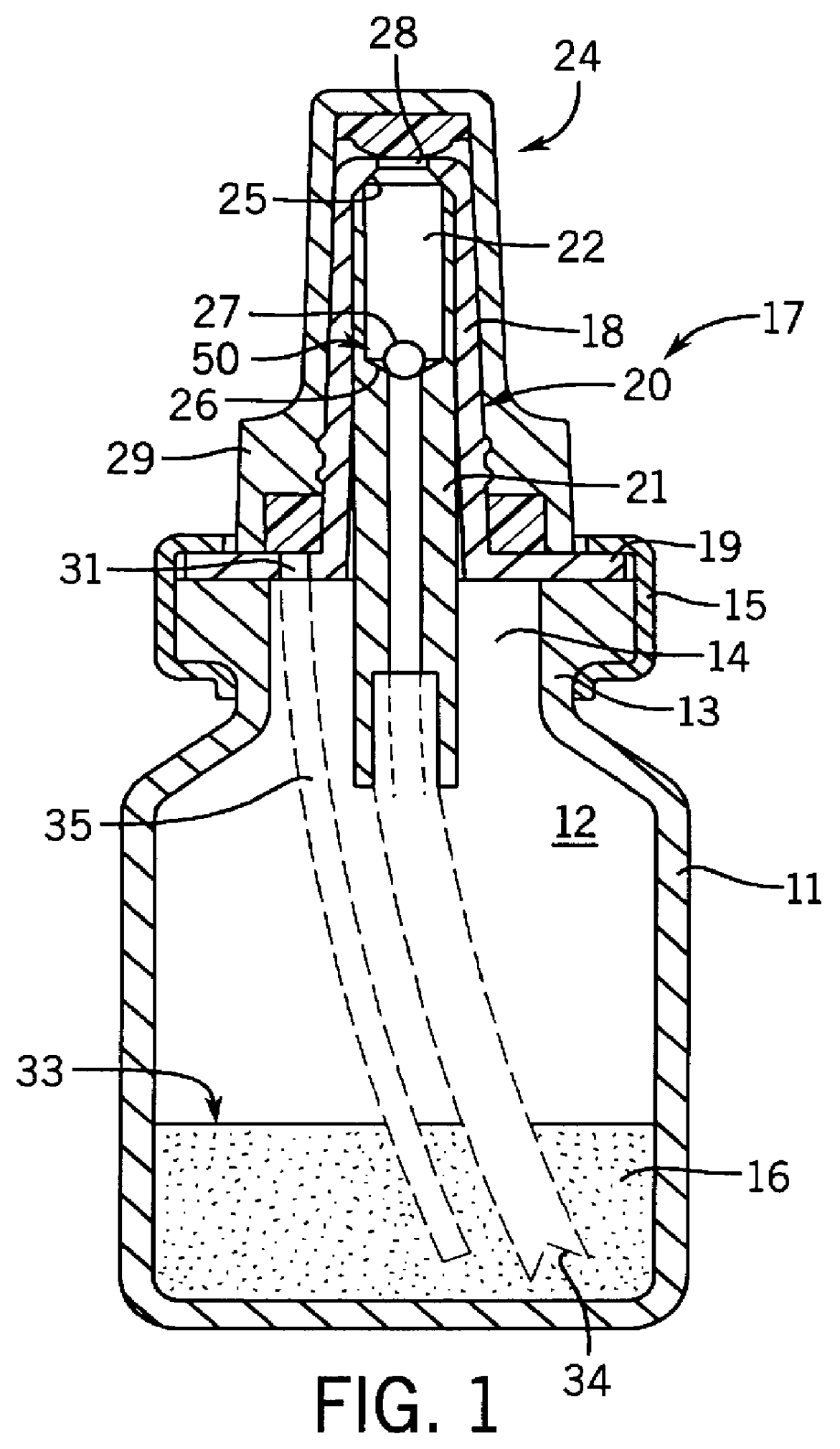

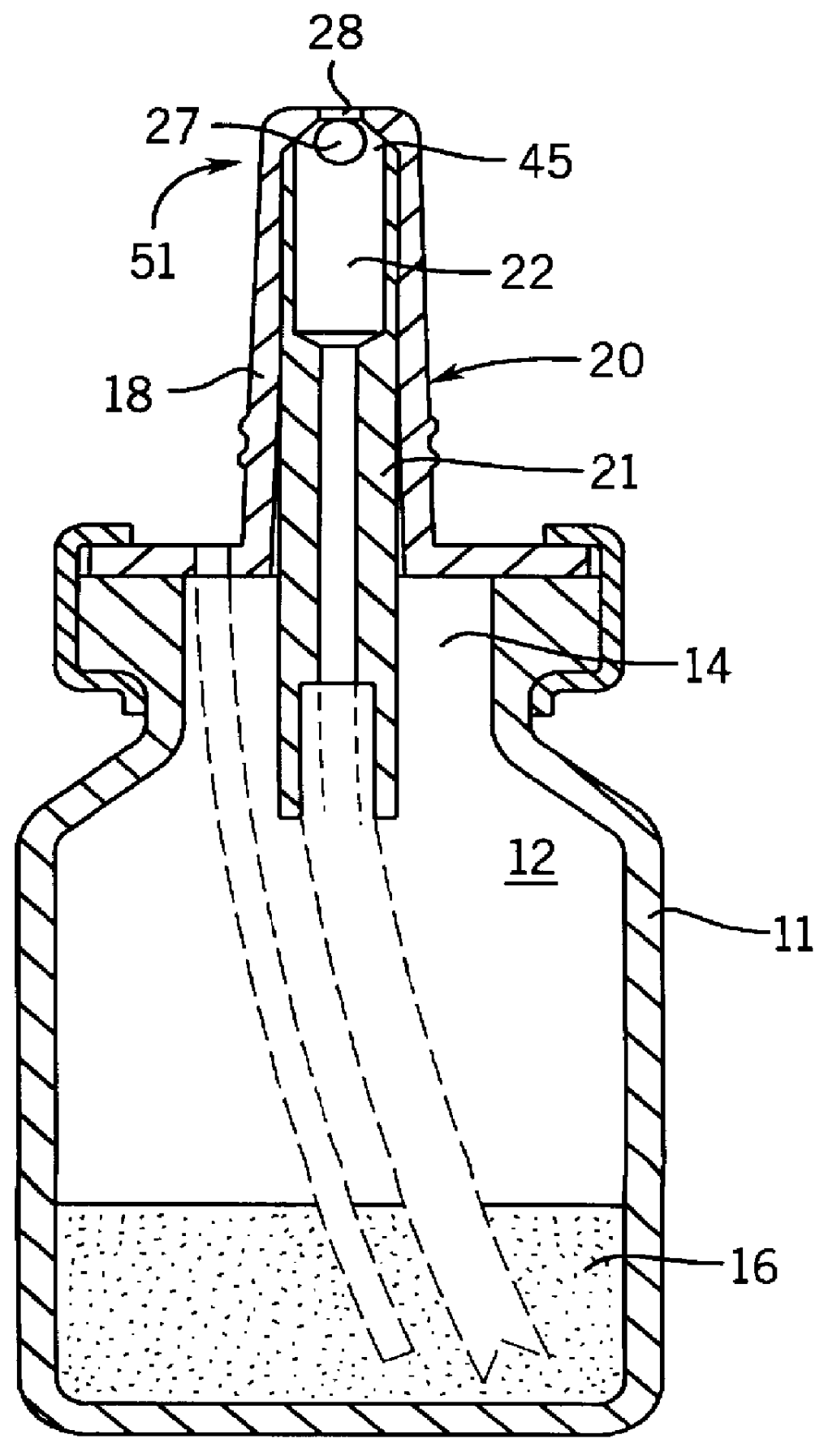

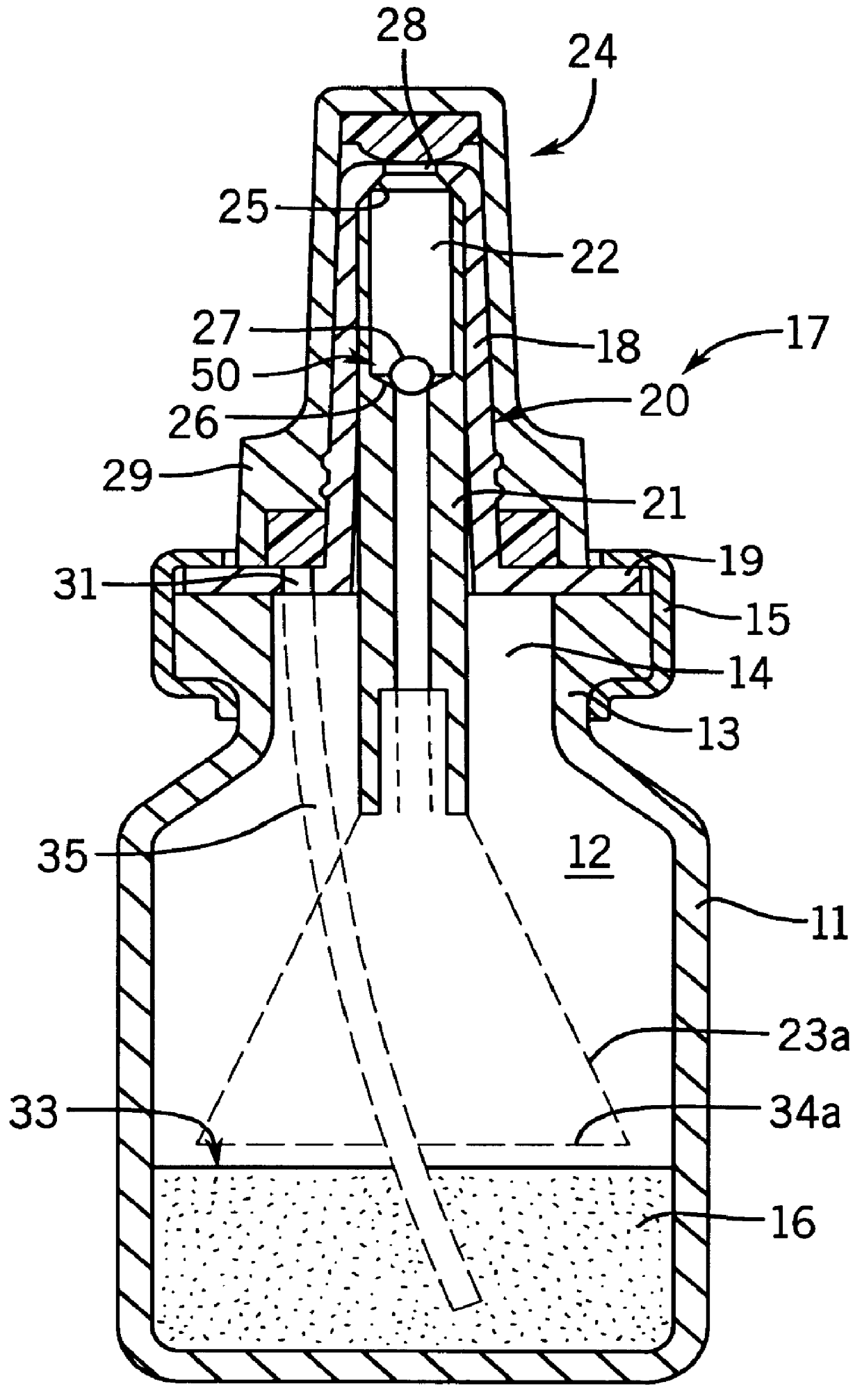

Dosing and discharging device for flowable media including powder/air dispersions

InactiveUS6055979ASimple processDosing is simpleRespiratorsLiquid surface applicatorsPre treatmentEngineering

A dosing device (17) for the medical administration of powder (16) through the nose or mouth has a valve body (27) which is movable in a discharge channel (22) between two valve seats (25, 26). During suction, the spherical valve body (27) is raised from the lower, container-sealing valve seat (26) and moved by a flow drag to the upper valve seat (25), so that it closes the discharge channel (22) and terminates dosing. The formation of the air / powder dispersion can be assisted in that the air subsequently sucked into the container is directed onto or into a powder supply or to a powder receiver in a pre-chamber fillable by tilting the device for pre-dosing.

Owner:ING ERICH PHEIFFER GMBH & CO KG

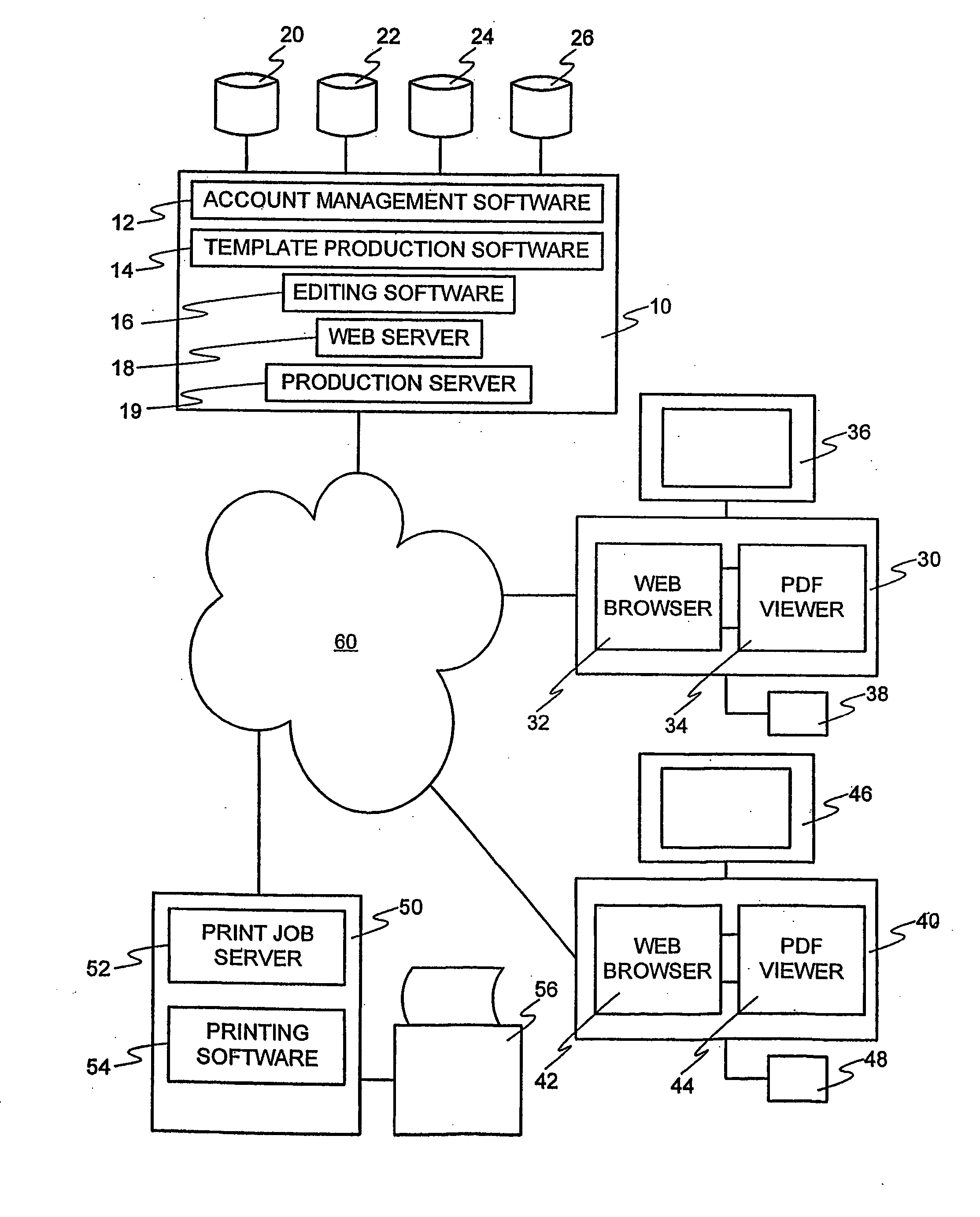

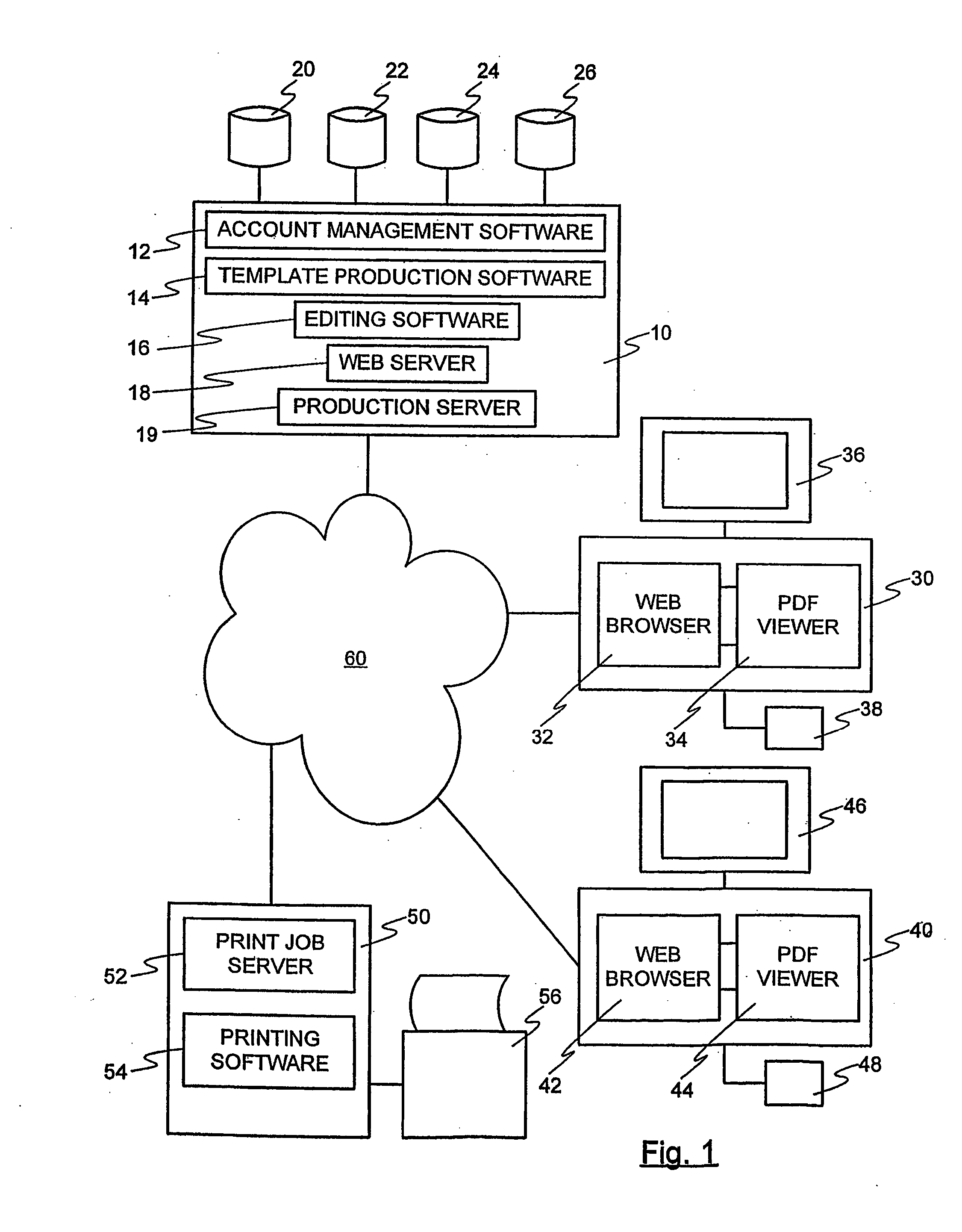

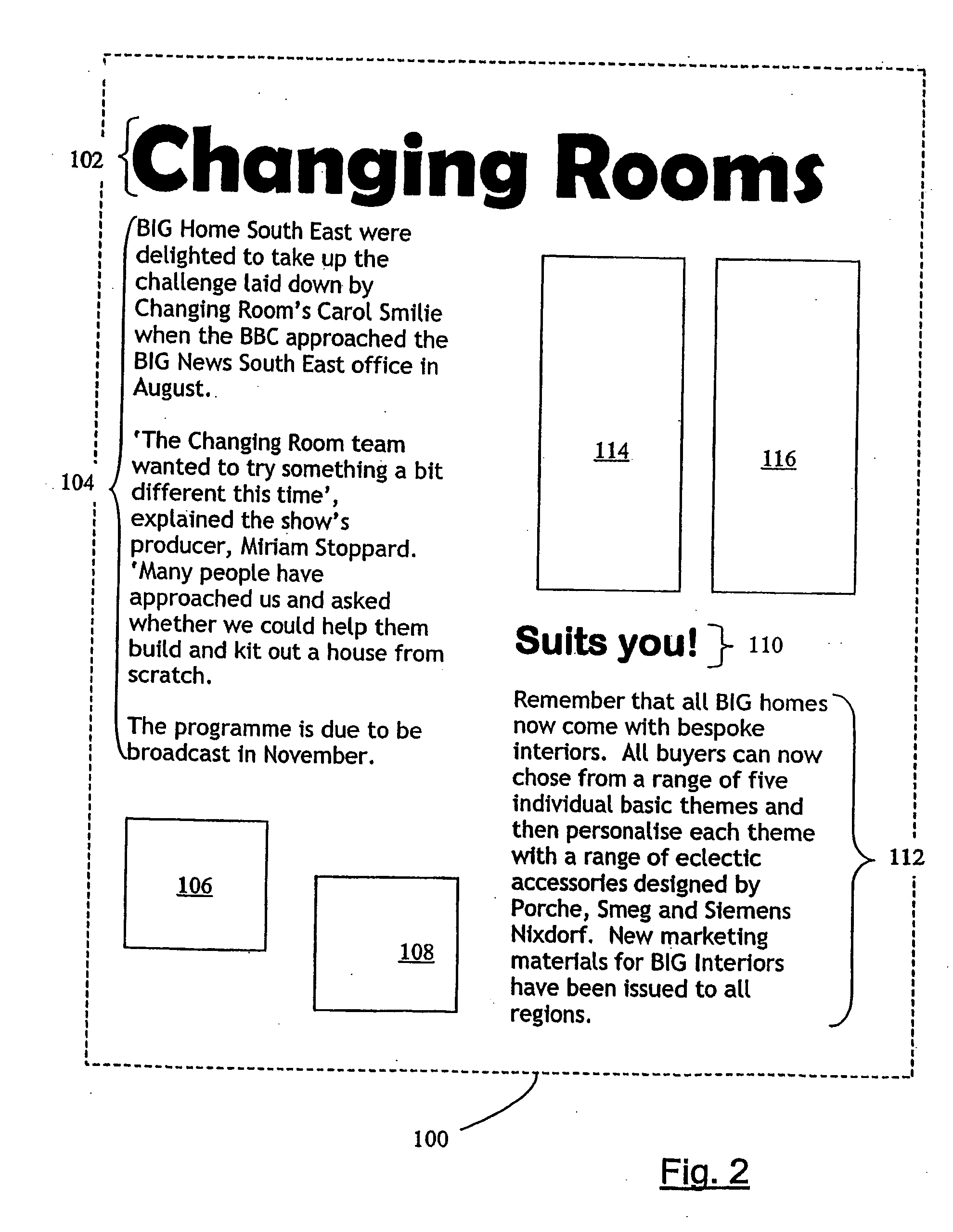

Electronic document processing

InactiveUS20050216836A1Simplify creationNatural language data processingSpecial data processing applicationsElectronic documentDigital document

A first electronic document is processed to produce a second electronic document. The second electronic document is an edited version of the first electronic document. The processing of the first electronic document includes using computer software to produce the second electronic document.

Owner:TRIPLEARC UK

Method and system of monitoring, sensor validation and predictive fault analysis

InactiveUS7451003B2Simplicity of implementationEasy maintenanceError detection/correctionVolume/mass flow measurementLinear correlationControl system

The present invention provides an improved method and system for real-time monitoring, validation, optimization and predictive fault analysis in a process control system. The invention monitors process operations by continuously analyzing sensor measurements and providing predictive alarms using models of normal process operation and statistical parameters corresponding to normal process data, and generating secondary residual process models. The invention allows for the creation of a fault analyzer directly from linearly independent models of normal process operation, and provides for automatic generation from such process models of linearly dependent process models. Fuzzy logic is used in various fault situations to compute certainty factors to identify faults and / or validate underlying assumptions. In one aspect, the invention includes a real-time sensor data communications bridge module; a state transition logic module; a sensor validation and predictive fault analysis module; and a statistical process control module; wherein each of the modules operates simultaneously.

Owner:FALCONEER TECH

Surgical method and apparatus for positioning a diagnostic or therapeutic element within the body

InactiveUS20050033285A1Simplify creationBeneficial therapeutic resultTransvascular endocardial electrodesInstrument handpiecesSurgical methodsCatheter device

A surgical method and apparatus for positioning a diagnostic or therapeutic element within the body. The apparatus may be catheter-based or a probe including a relatively short shaft.

Owner:EP TECH

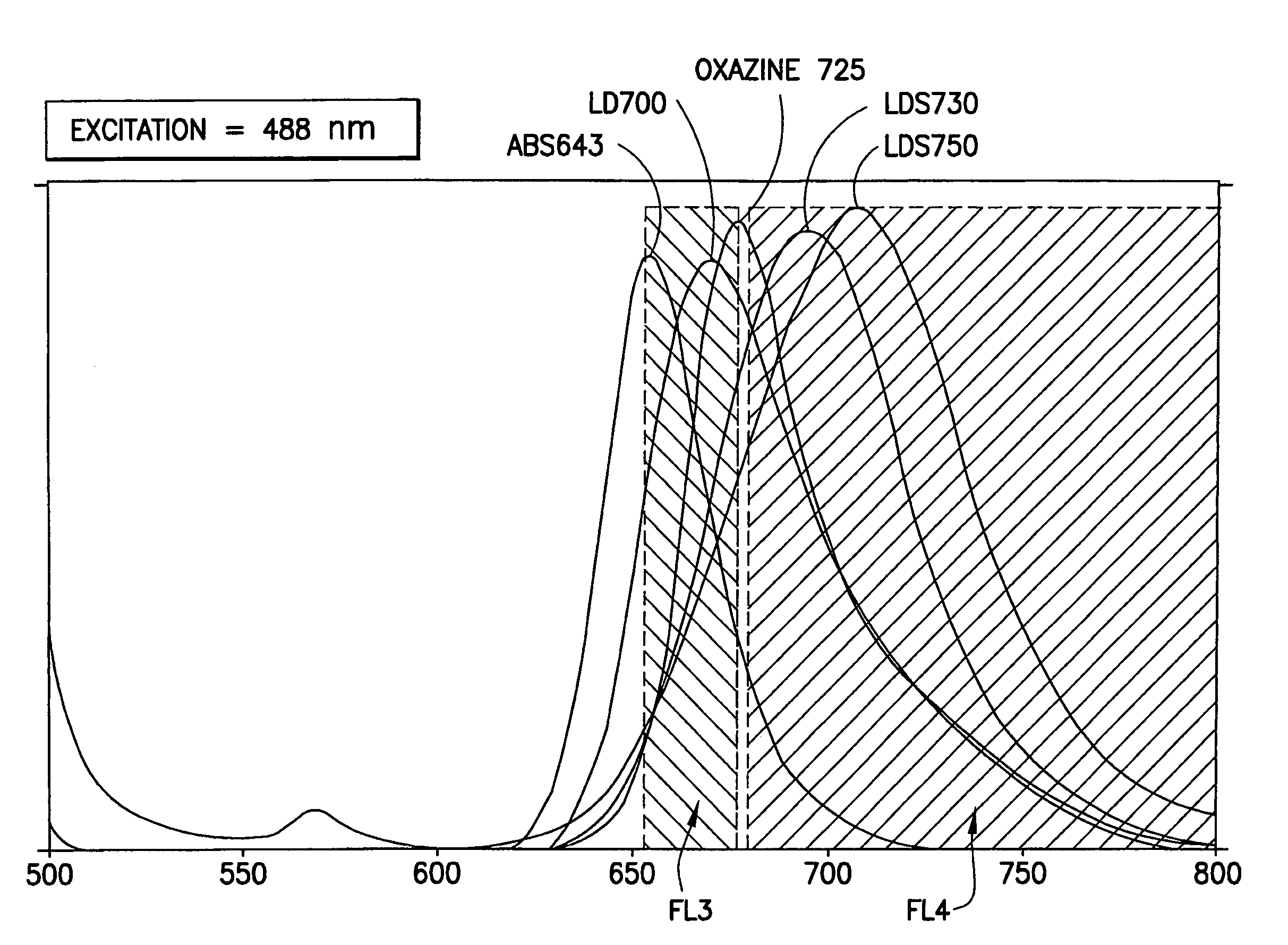

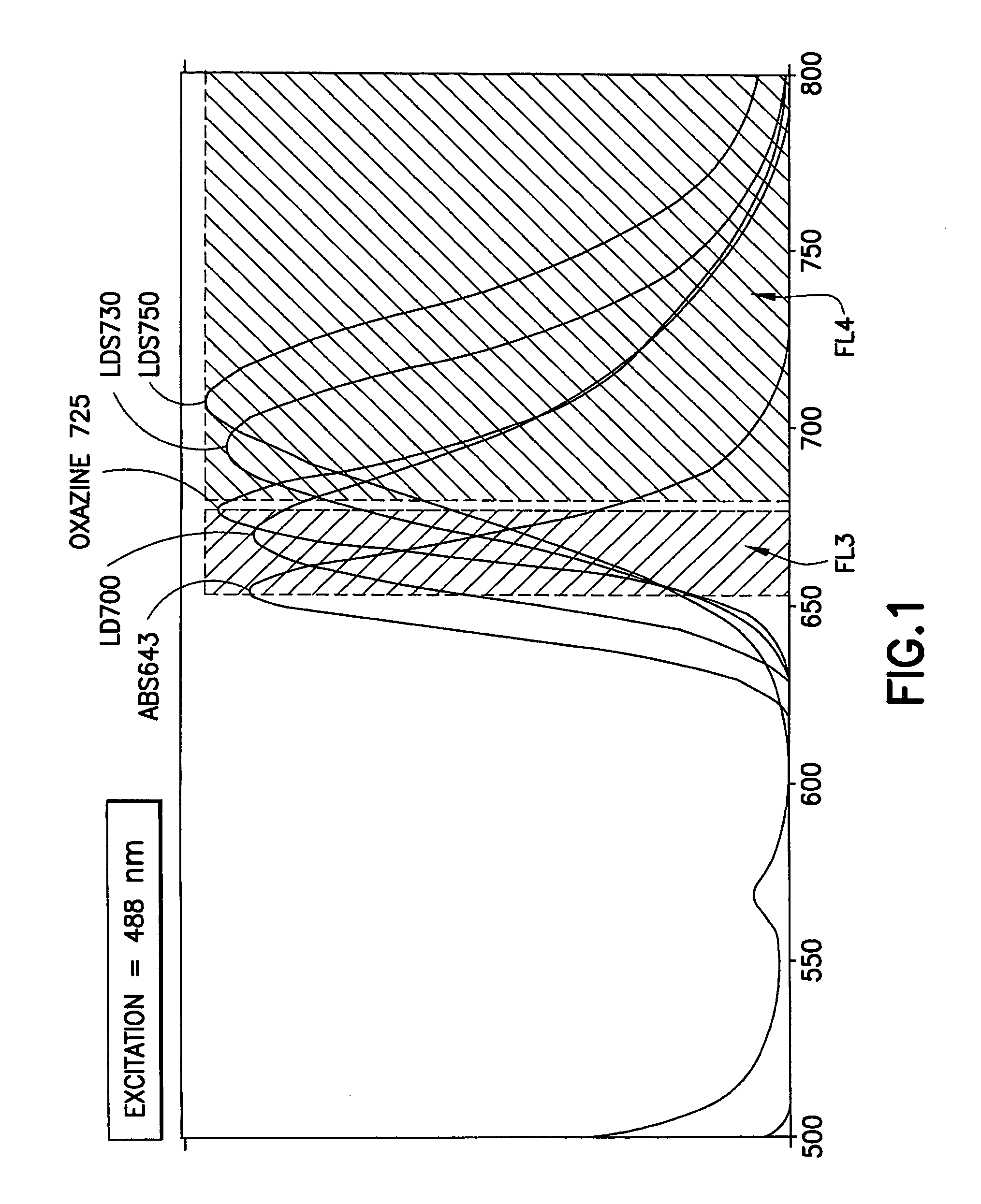

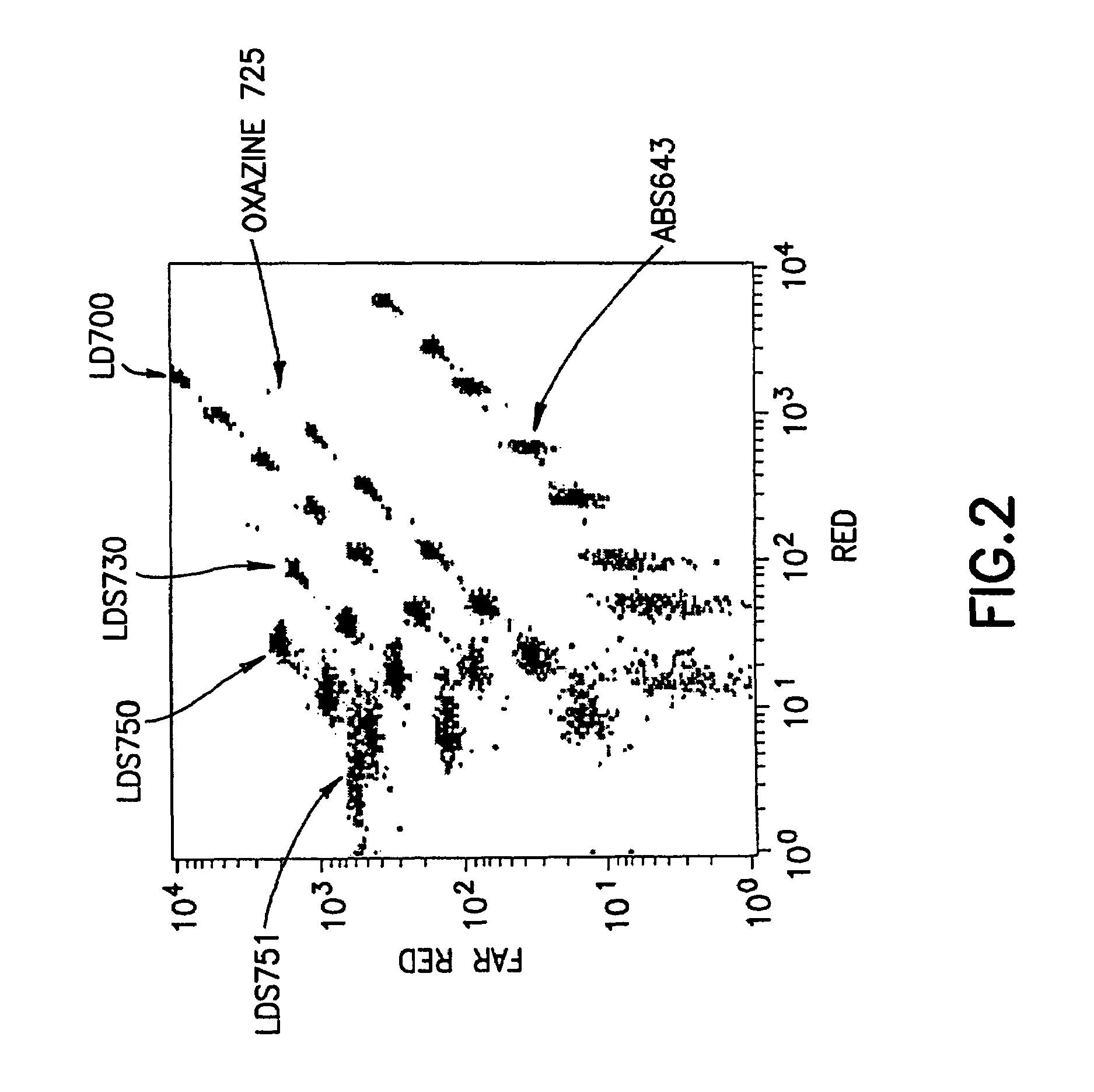

Multiplex microparticle system

ActiveUS7507588B2Simplify creationNone provides advantagesBioreactor/fermenter combinationsBiological substance pretreatmentsMulti analyteMicroparticle

Arrays of microparticle populations, each population labeled with a single fluorescent dye, are provided for use in multiplex assays. The populations form a virtual multidimensional array wherein each microparticle is identified by fluorescence intensity in two different fluorescence detection channels. The arrays are useful in a variety of assays, including multiplex, multi-analyte assays for the simultaneous detection of two or more analytes by, for example, flow cytometry, and a labeling reagents in, for example, microscopy. The use of singly-dyed microparticles to form multidimensional arrays greatly simplifies the creation of multiplex assays.

Owner:BECTON DICKINSON & CO

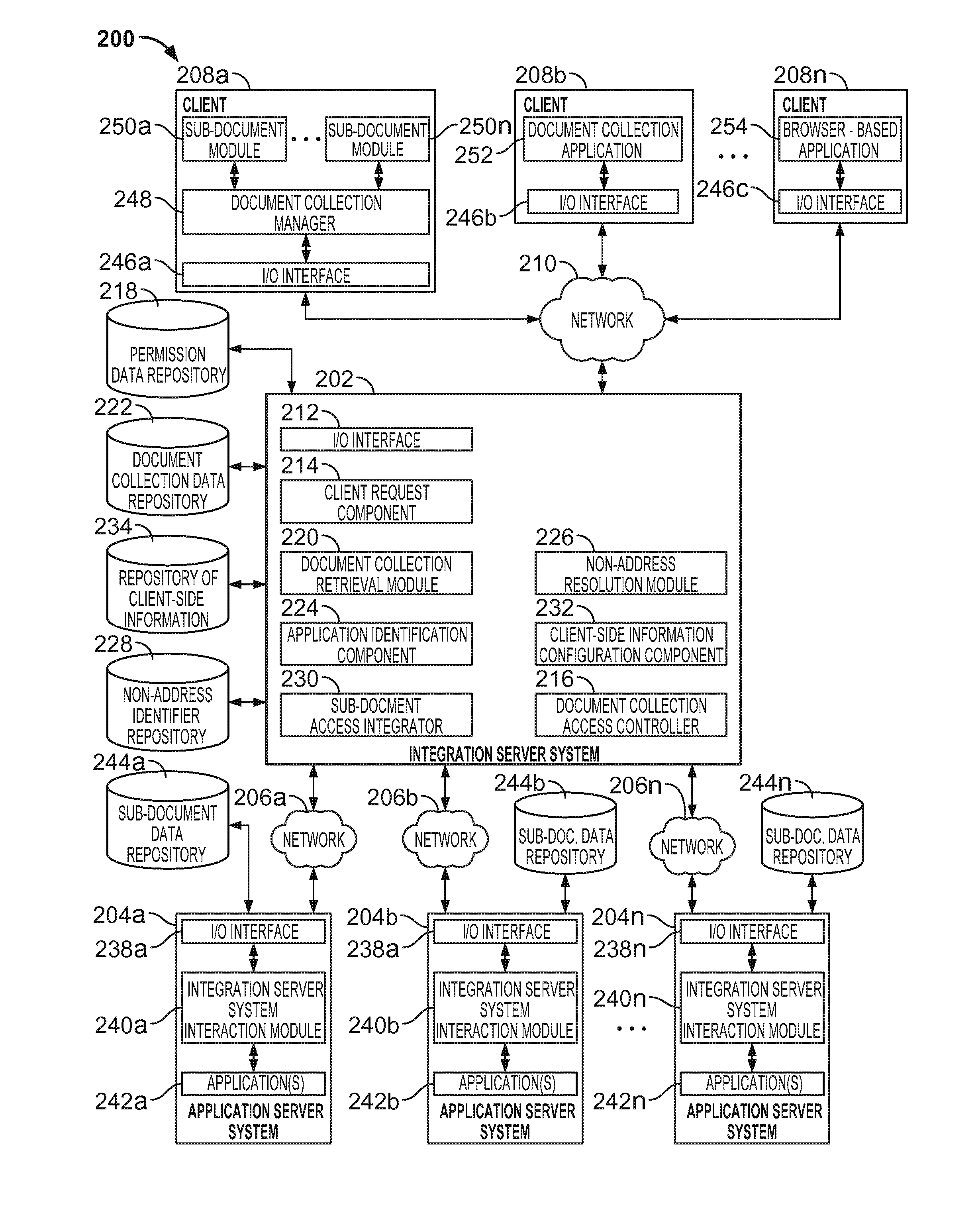

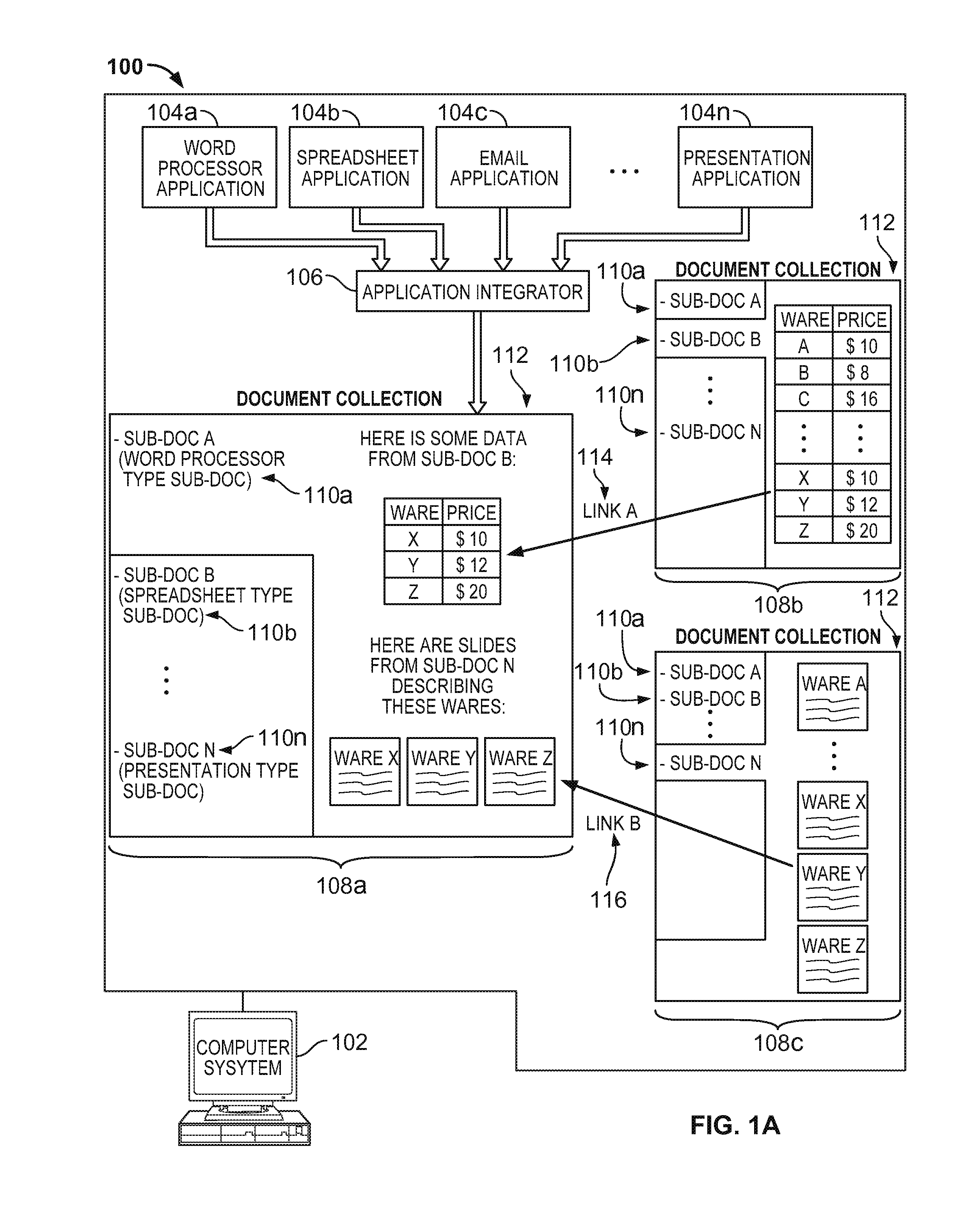

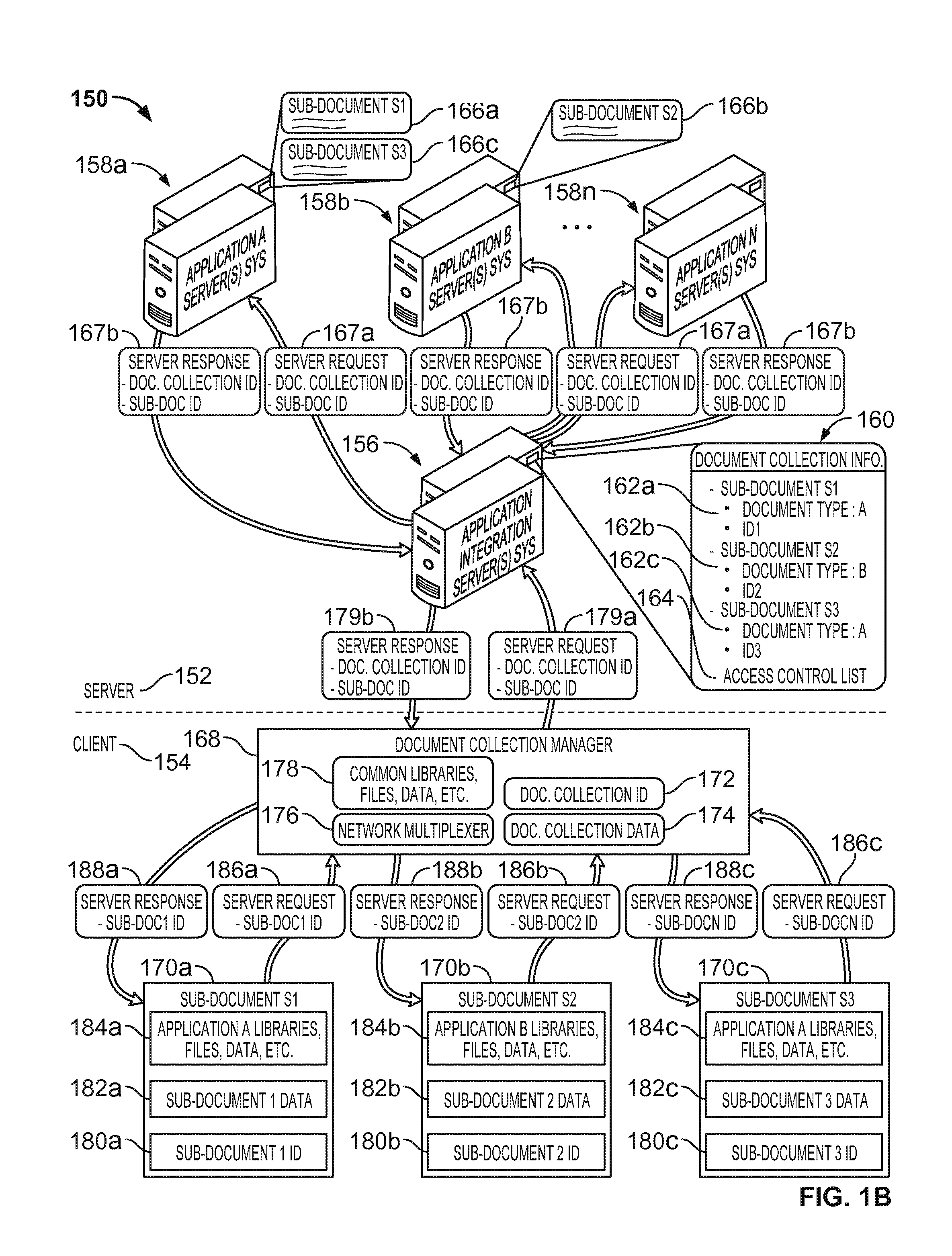

Providing an Electronic Document Collection

InactiveUS20110296507A1Easy for userLess autonomyDigital data processing detailsUser identity/authority verificationElectronic documentDocument Type Code

In one implementation, a computer-implemented method includes receiving a request to access an electronic document collection that integrates a plurality of electronic sub-documents that are each of one of a plurality of defined document types. The method also includes retrieving information that is associated with the document collection, wherein the retrieved information identifies a first sub-document of the plurality of sub-documents using a first non-address identifier, and identifying a first software application that is configured to provide access to the first sub-document. The method additionally includes initiating a first connection with a first server that causes execution of the identified first software application and that, using the first non-address identifier, provides access to the first sub-document. The method further includes integrating access to the first sub-document into the document collection through the initiated first connection with the first server that causes execution of the first software application.

Owner:GOOGLE LLC

Fluid-operated medical or dental handheld element

A fluid-operated medical or dental handheld element is disclosed, having a connecting device for connecting the handheld element to a fluid source so that a first impeller can be induced to rotate by a fluid stream to cause a tool to execute a driving motion, a fluid conducting device arranged between the connecting device and the first impeller for conveying a fluid stream away from or toward the first impeller, and a generator for generating electric power. The generator includes a second rotatable impeller that can be driven by at least a substream of the fluid stream conveyable in the first fluid conducting device. One result is more constant generation and output of power by the generator independent of the rotational speed of the first impeller, thereby insuring a more constant power supply to a power consuming device connected to the generator.

Owner:W&H DENTALWERK

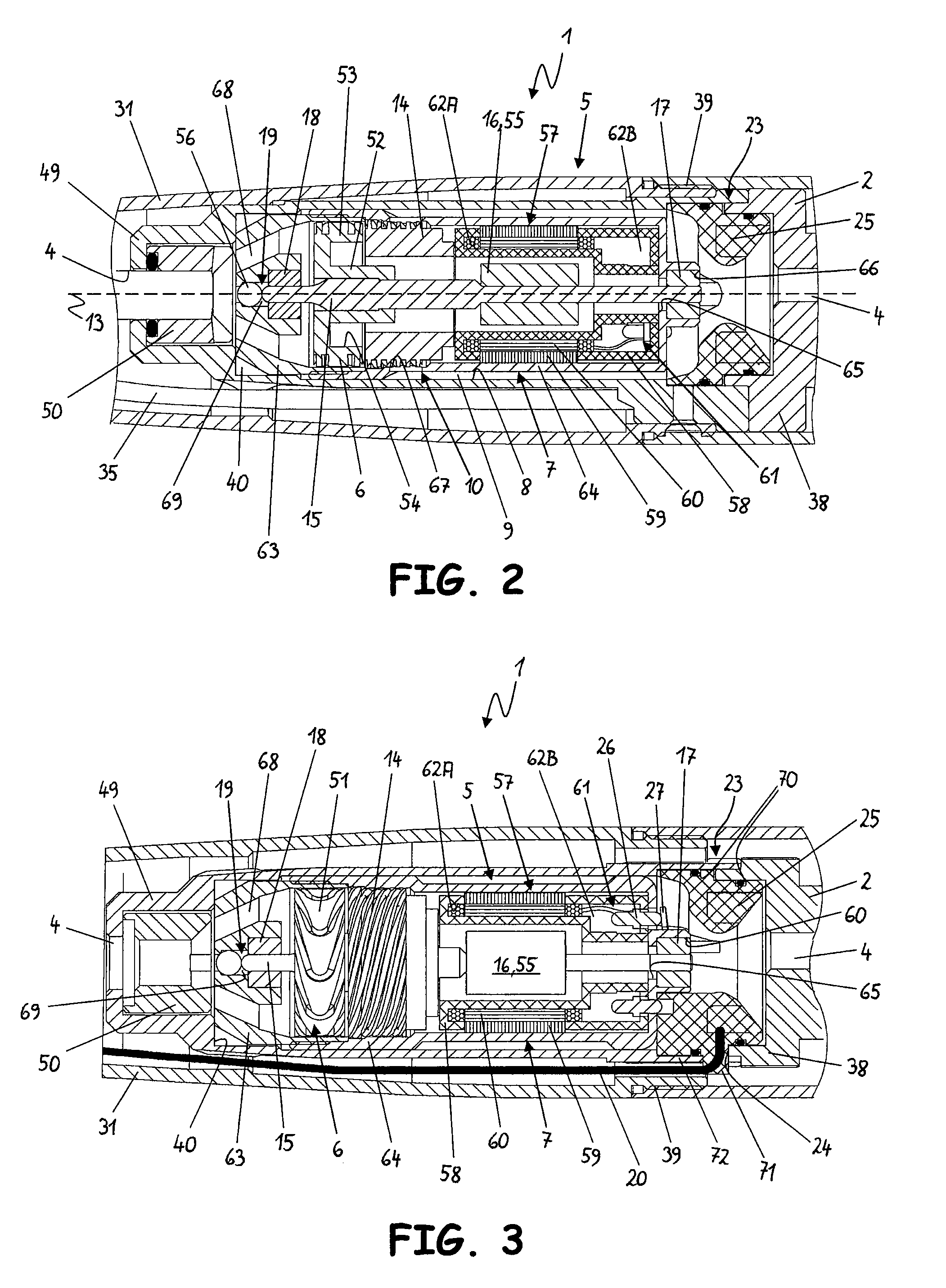

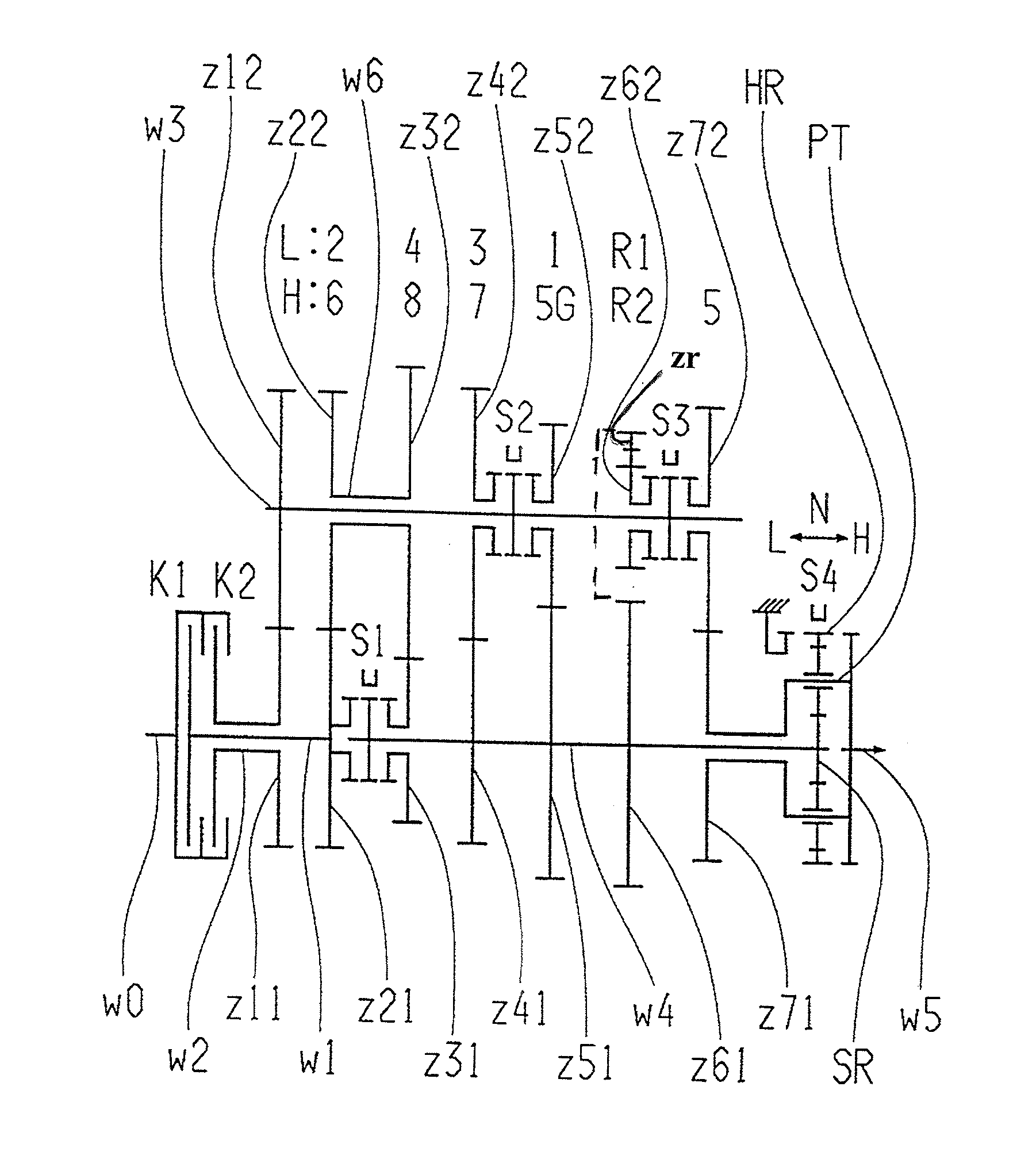

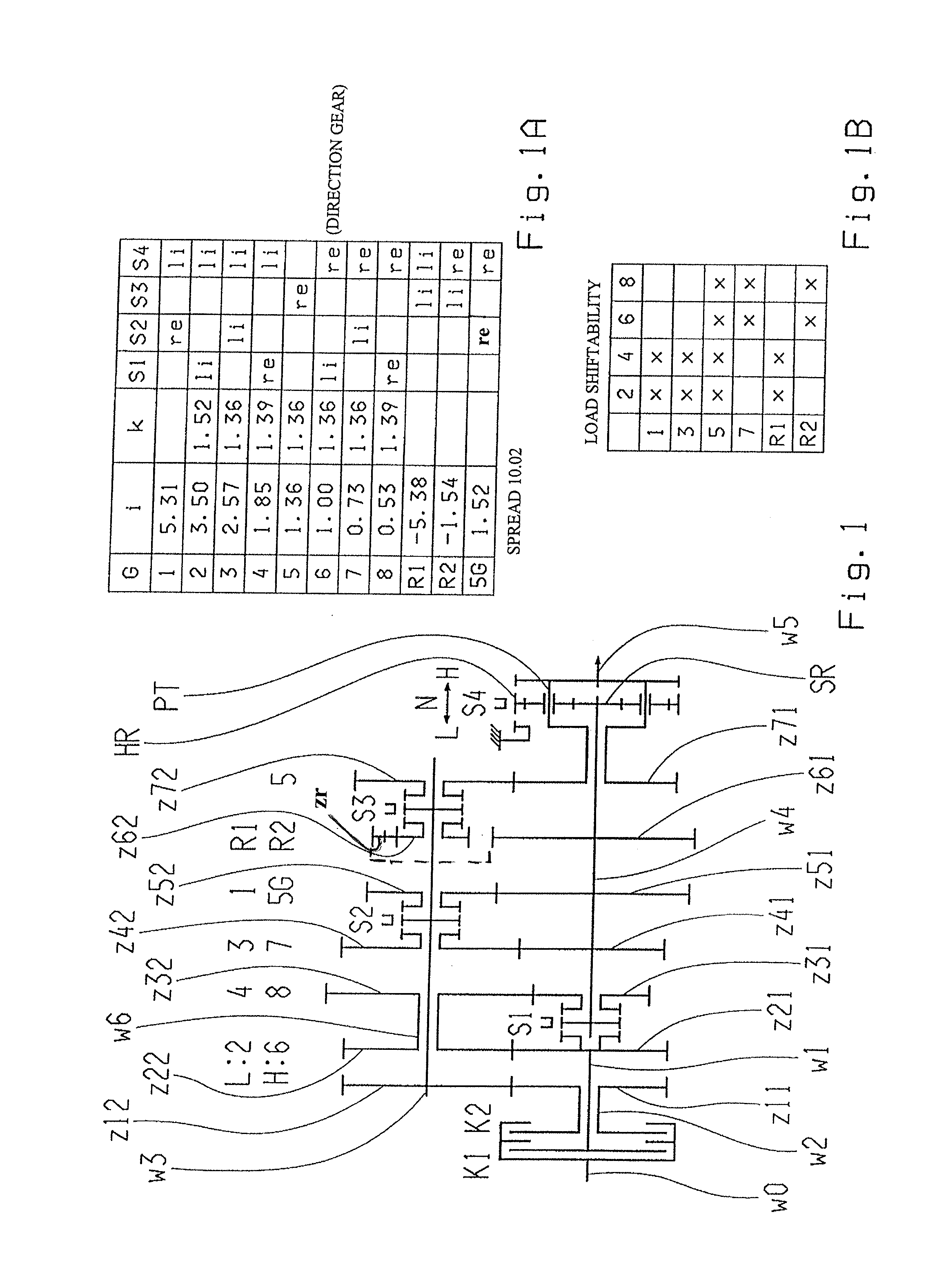

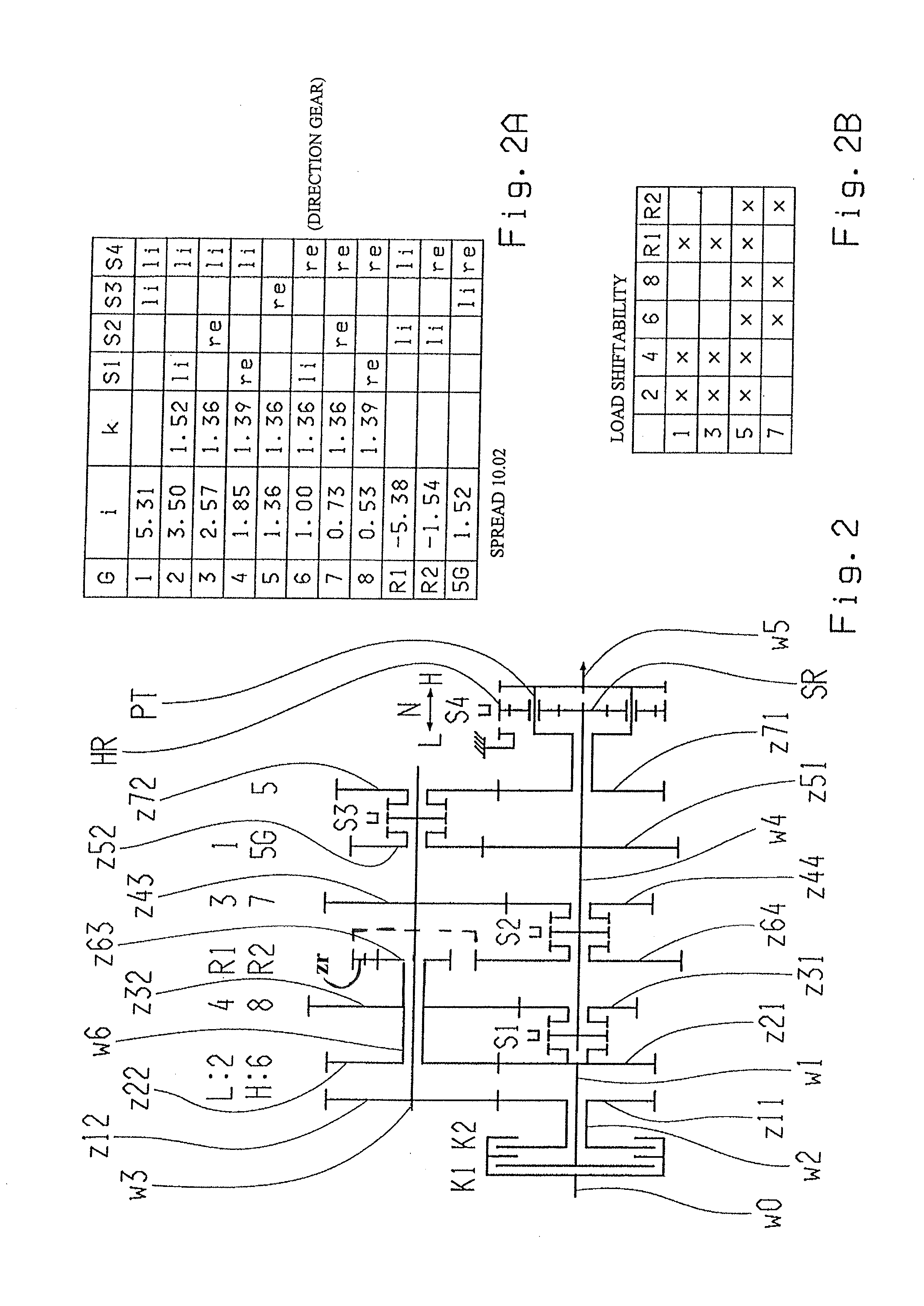

Dual clutch gearbox

A double clutch transmission with two clutches (K1, K2) is proposed in which each clutch inputs is connected with a drive shaft (w0) and the clutch outputs are respectively coupled with two, coaxial positioned transmission input shaft (w1, w2) of partial transmissions. The double clutch transmission comprises two counter shafts (w3, w6), coaxial positioned with respect to one another. Each partial transmission has several, shiftable gear ratio steps assigned thereto which each can be coupled with the output shaft (w5), via the assigned counter shaft (w3, w6) and via a main shaft (w4) which is linked to an input section of a planetary transmission which is designed as range group, The output shaft (w5) is positioned coaxially with respect to the driveshaft (w0). At least one shiftable gear ratio step, of at least one of the partial transmissions, can be coupled with the output shaft (w5) independent from the range group.

Owner:ZF FRIEDRICHSHAFEN AG

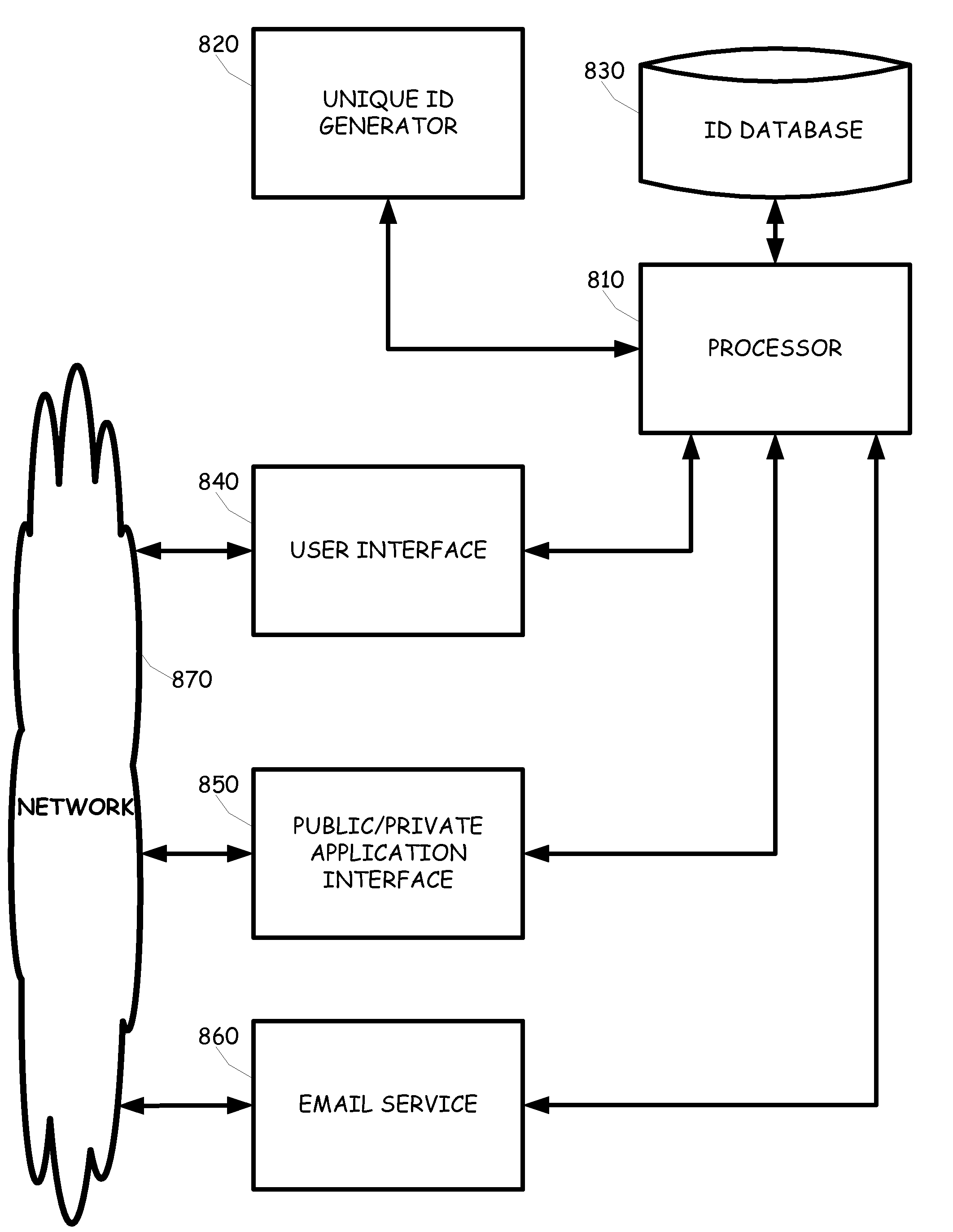

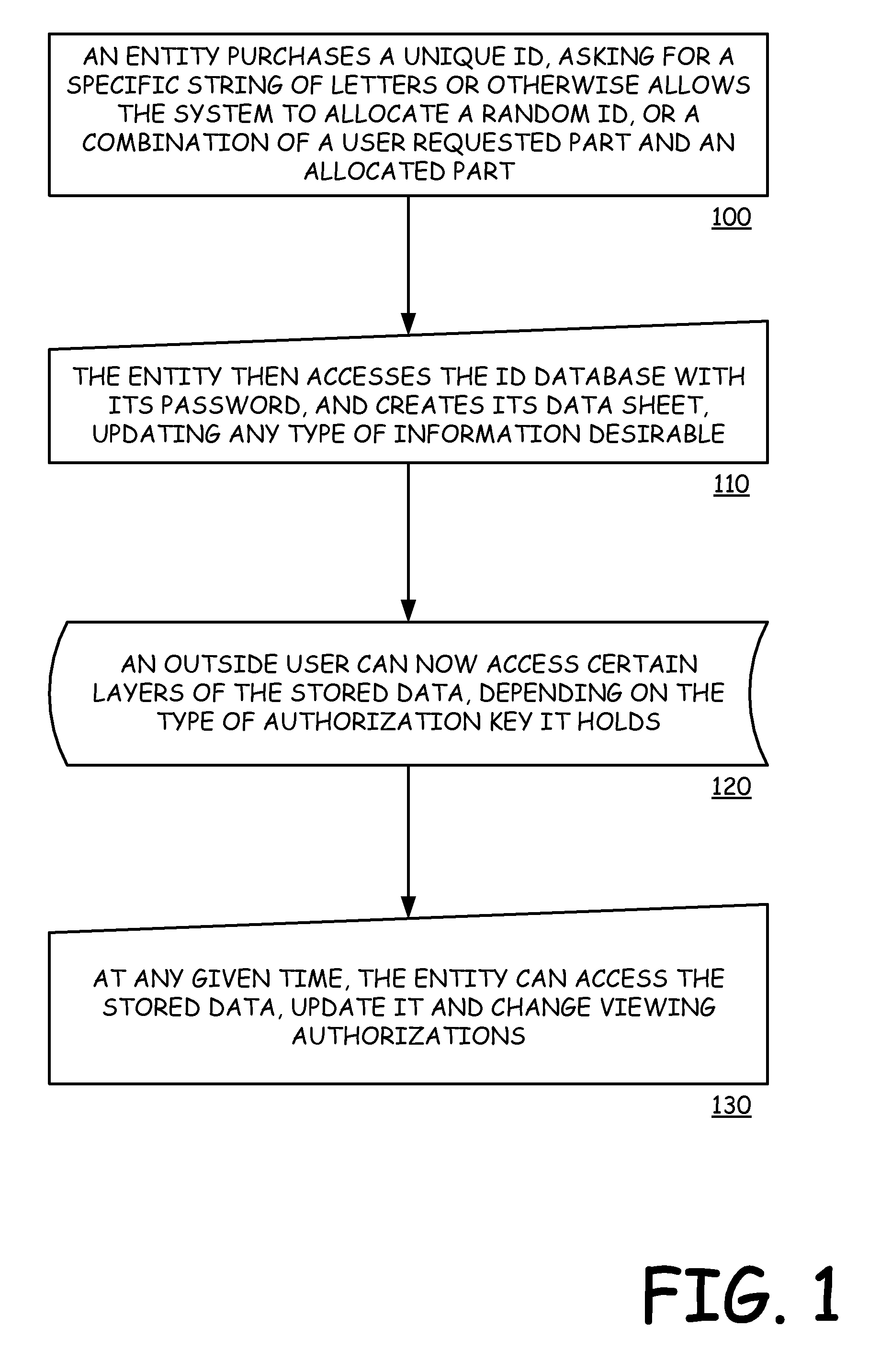

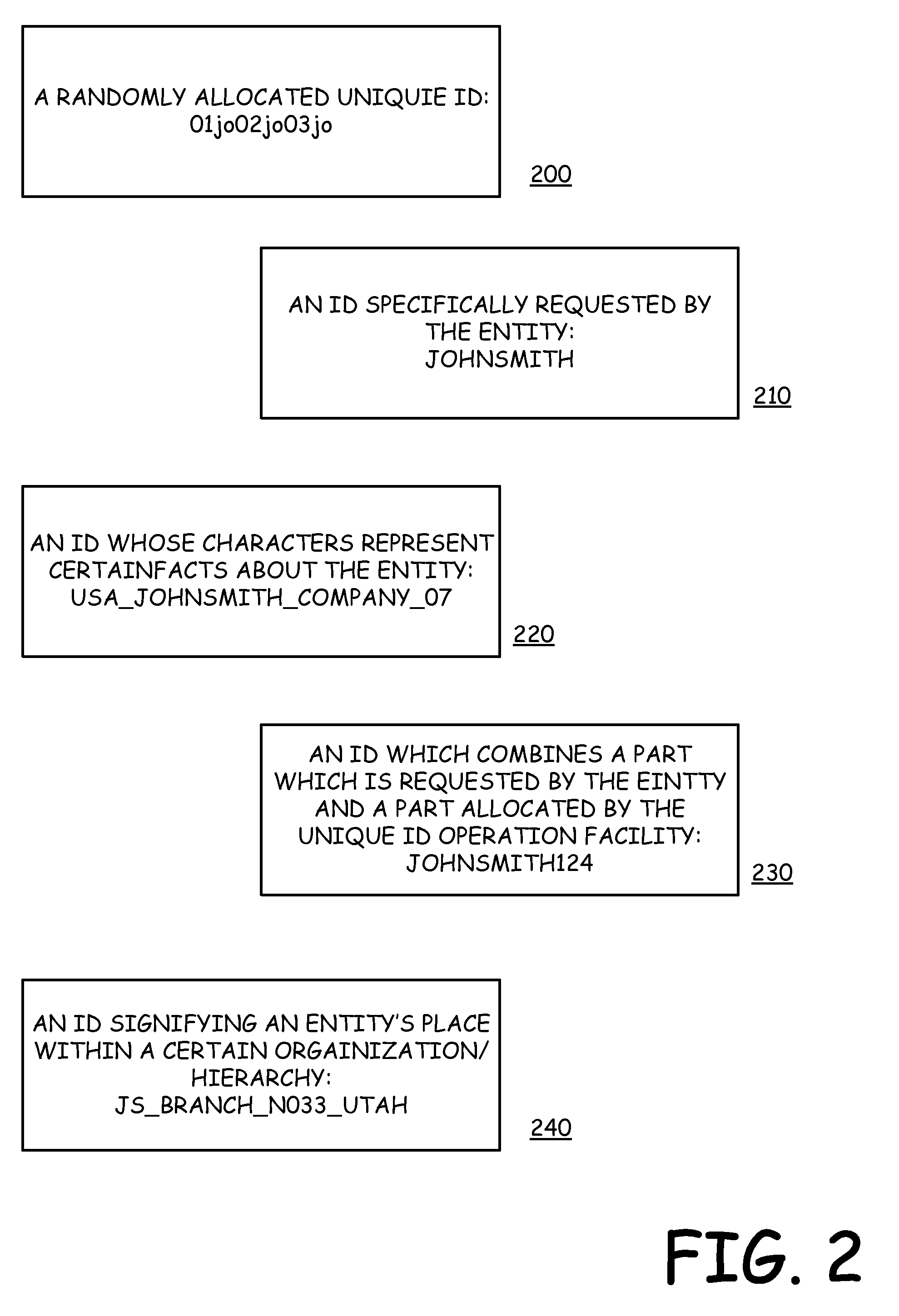

Method and apparatus for global unique identifier, including id database

InactiveUS20090187979A1Simple methodSimplify creationDigital data processing detailsUser identity/authority verificationUnique identifierDatabase

An entity can request the generation of a unique identifier to serve as a common identifier for the entity immune to changes in the entities contact information. A data base entry indexed at least in part by the unique identifier can be created for housing further contact information for the entity. The unique identifier can remain a constant focal point for contacting the entity or obtaining contact information about the entity. The entity can update contact information in the data base entry and as such, the unique identifier can be used to access current contact information.

Owner:SEVER GIL

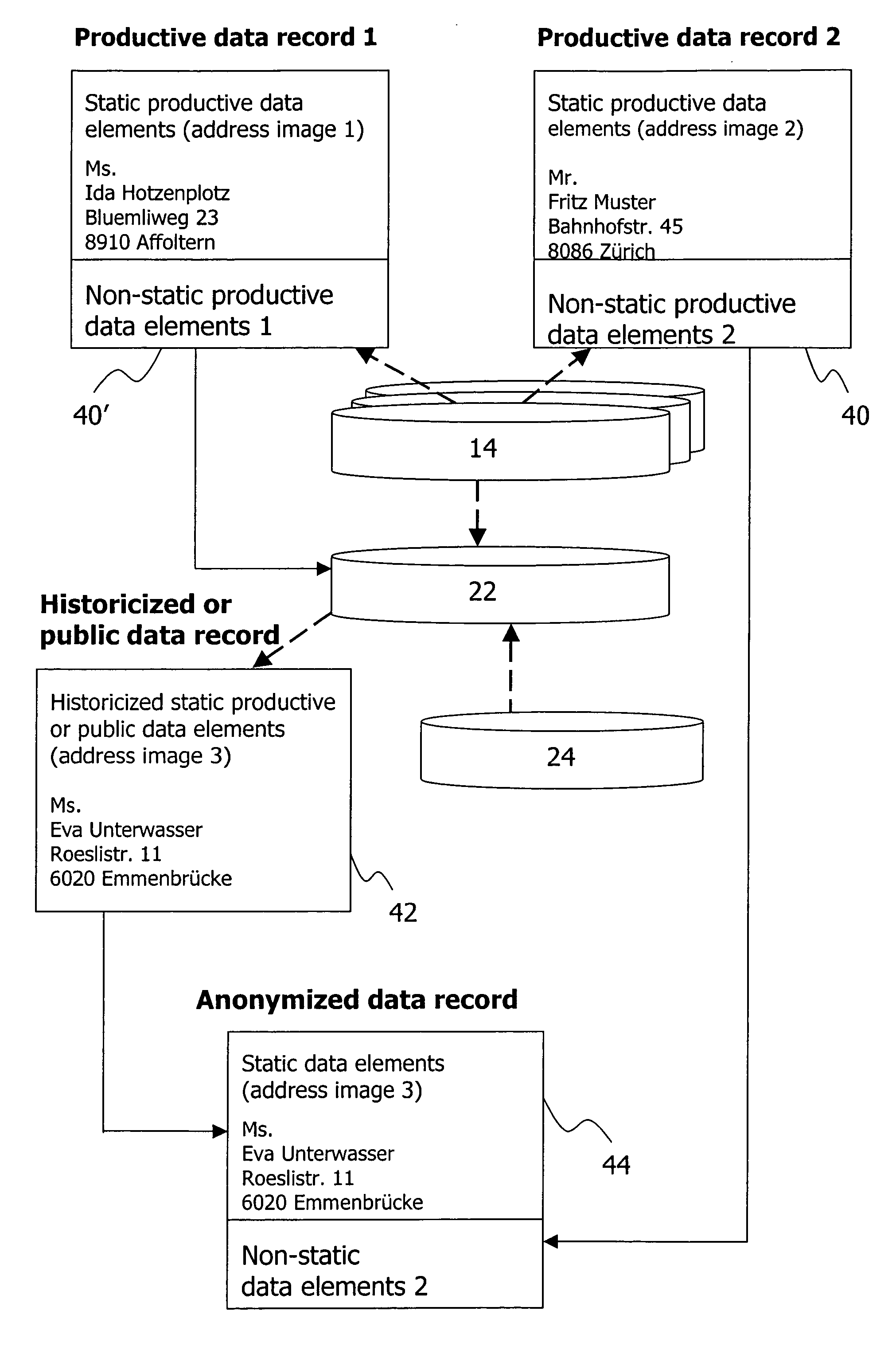

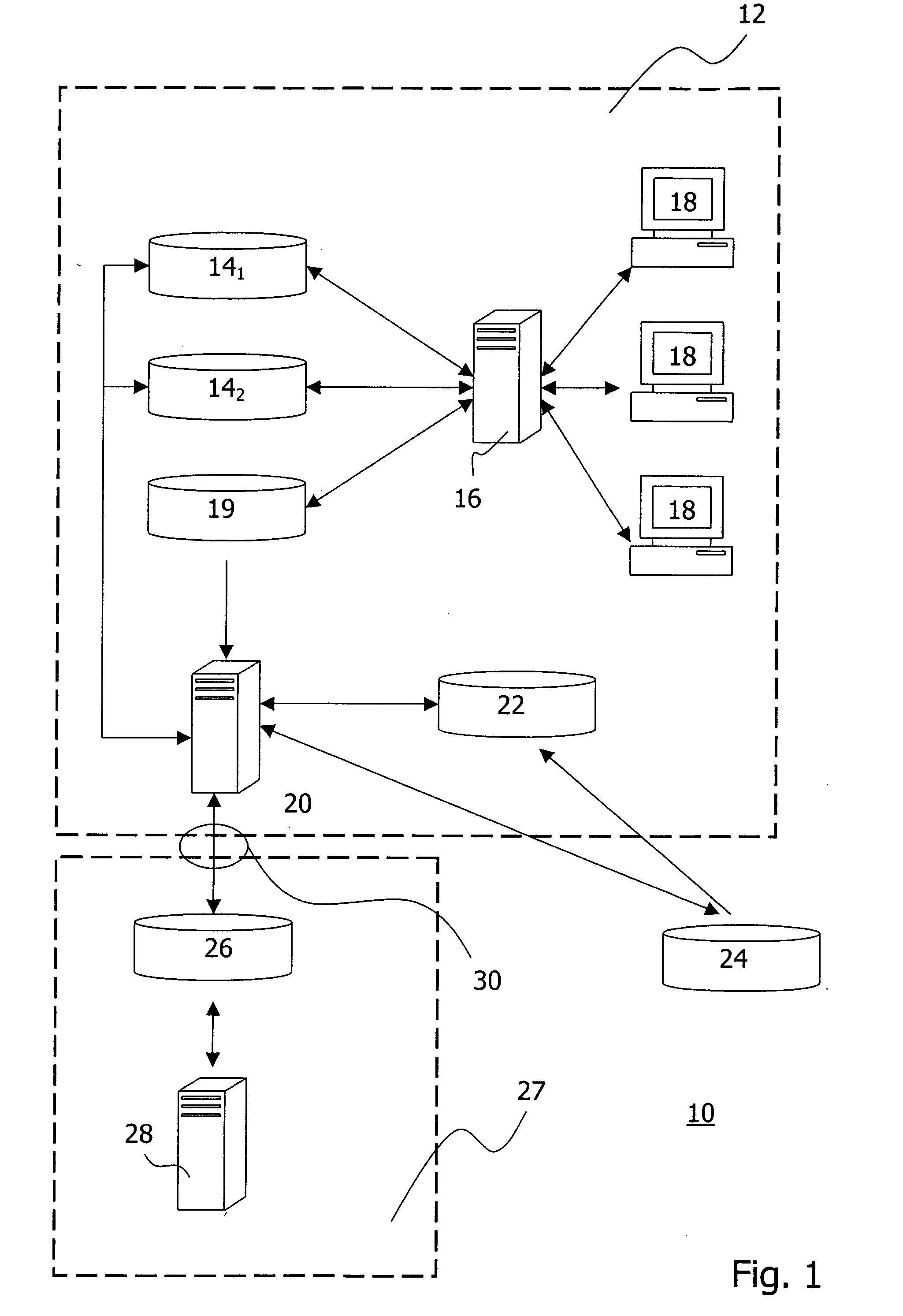

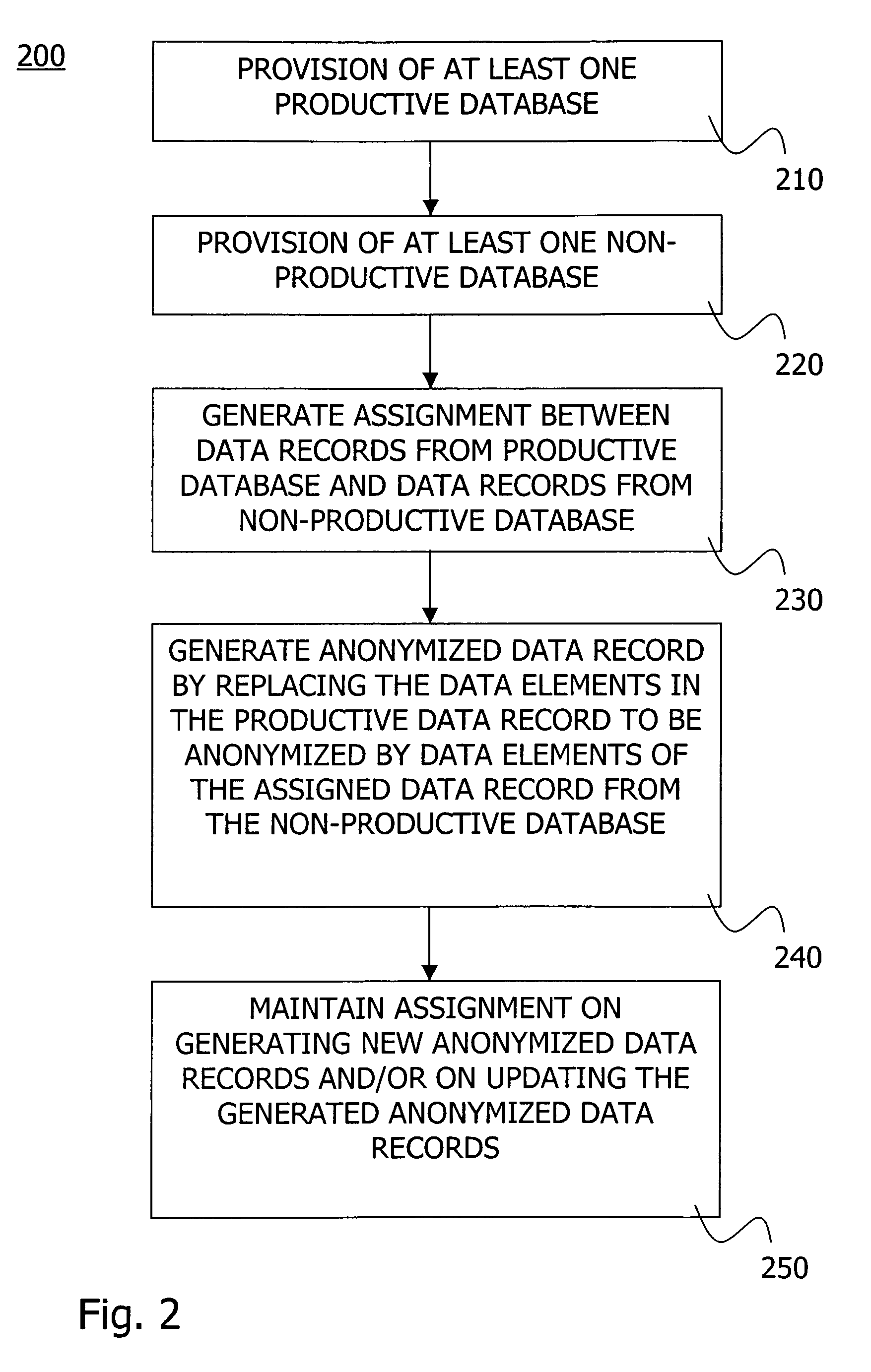

Generation of updatable anonymized data records for testing and developing purposes

InactiveUS20060059189A1Inaccurate analysisSimplify creationDigital data information retrievalDigital data processing detailsComputer-aidedComputer aid

A mechanism is described for the computer-aided generation of anonymized data records for developing and testing application programs that are intended for use in a productive network (12). A method according to the invention comprises the provision of at least one productive database (14) containing data records that contain productive data elements to be anonymized, provision of at least one non-productive database (22) containing data records that likewise contain data elements, the generation of an assignment between data records of the non-productive database (22) and data records of the productive database (14), and also the generation of an anonymized data record by replacing the data elements to be anonymized in a data record from the productive database (14) with the data elements of an assigned data record from the non-productive database (22). The assignment is maintained during a later generation of new anonymized data records and / or during an updating of already generated anonymized data records in order to be able to maintain the test data and in order to make simpler error analysis possible.

Owner:UBS BUSINESS SOLUTIONS AG

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com