Patents

Literature

74 results about "Payment procedure" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Payment Procedures. Inter-branch payments. All inter-branch payments (weekly market shopping, raw materials and finished. goods purchased from the head office) should be processed by the accountant. as soon as the goods have been delivered to the branch.

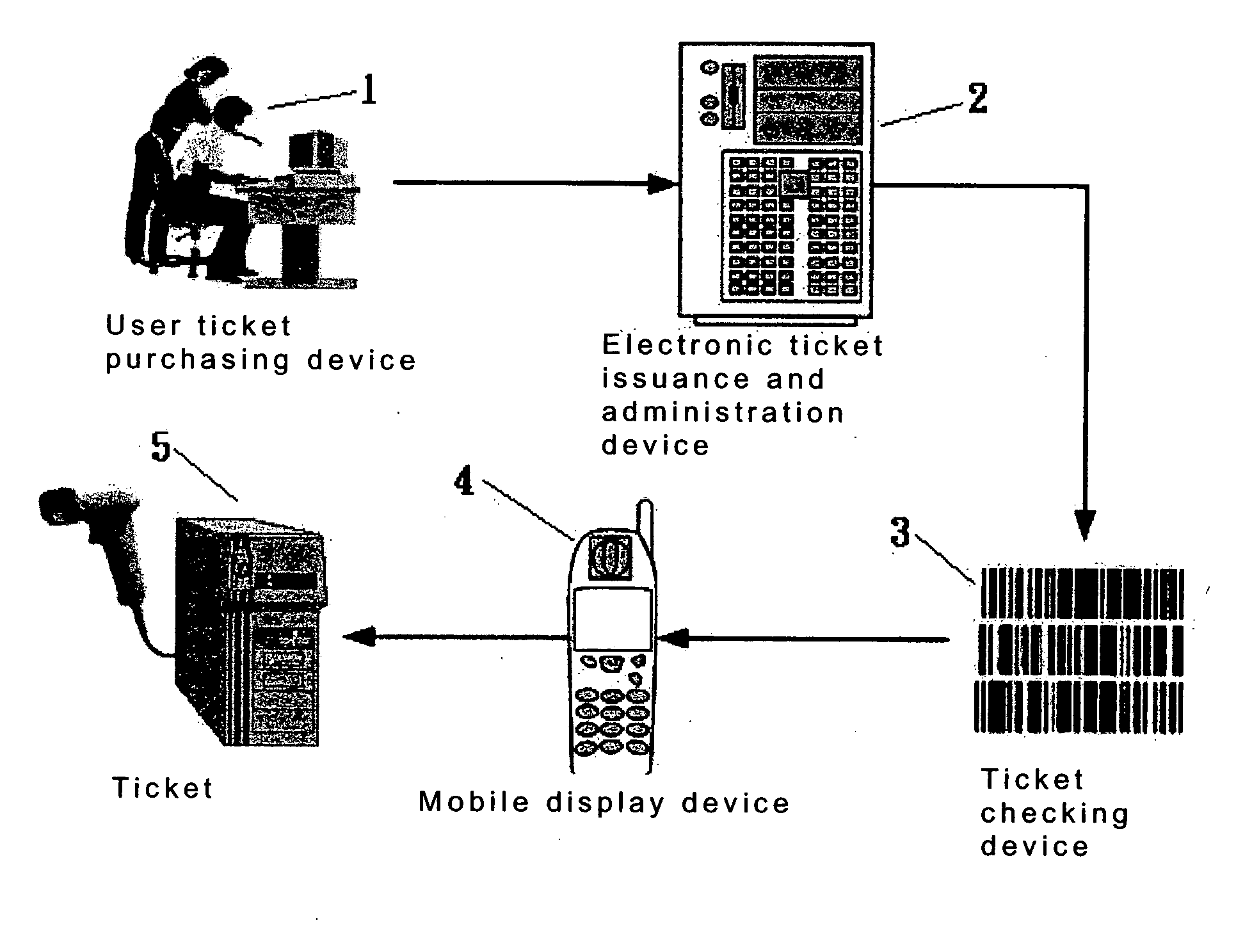

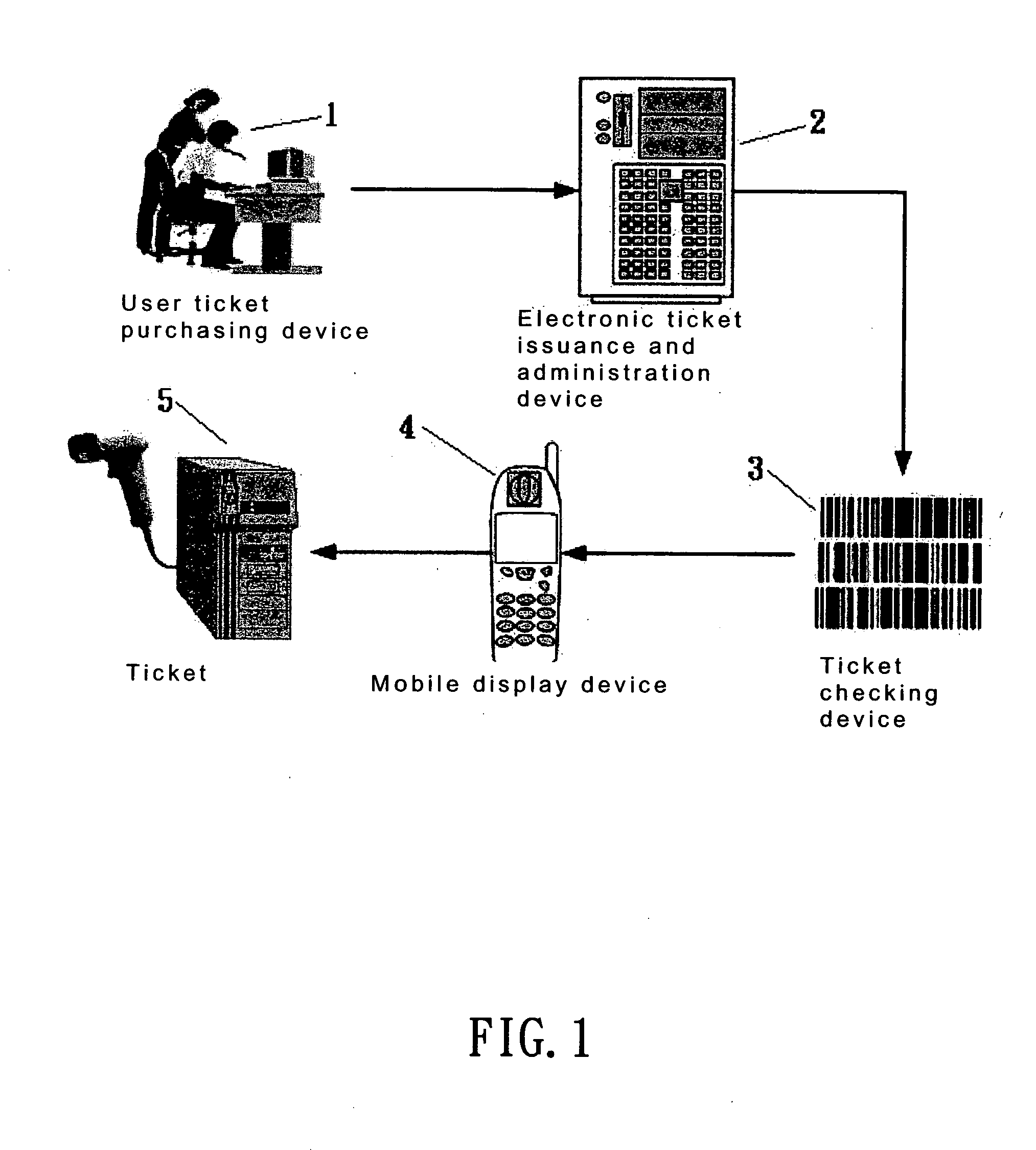

Electronic-ticket service system based on color-scale-code image recognition

InactiveUS20060293929A1Accurate verificationAccurate identificationInstruments for road network navigationReservationsColor ScaleWireless transmission

An electronic ticket service system based on color scale image recognition for individual identification, purchasing certificate or bill payment. Different from the conventional black-and-white one- or two-dimensional barcode, the color scale uses assembly of color scales for various colors. Each assembly of multiple color scales represents one element, such that the information capacity is greatly increased. The user can order the ticket via phone or internet. When the user has successfully input the purchase information and complete the payment procedure, the electronic ticket service center can issue and transmit the electronic ticket containing the color scale code to the assigned device through multimedia or wireless transmission. The assigned device can be cellular phones or other mobile communication terminal devices. Upon entrance, the electronic ticket displayed by the cellular phones or the mobile communication terminals is verified by a ticket verification device.

Owner:CHUNGHWA TELECOM CO LTD

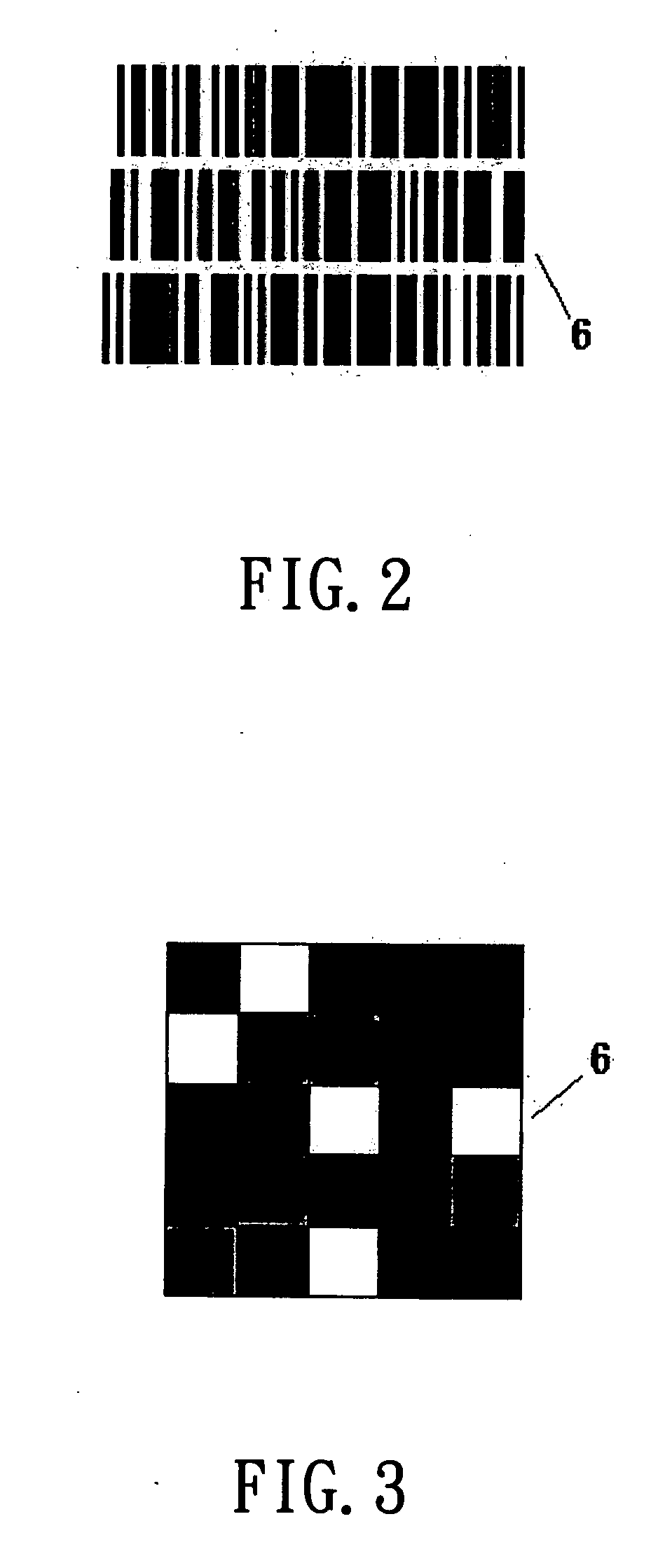

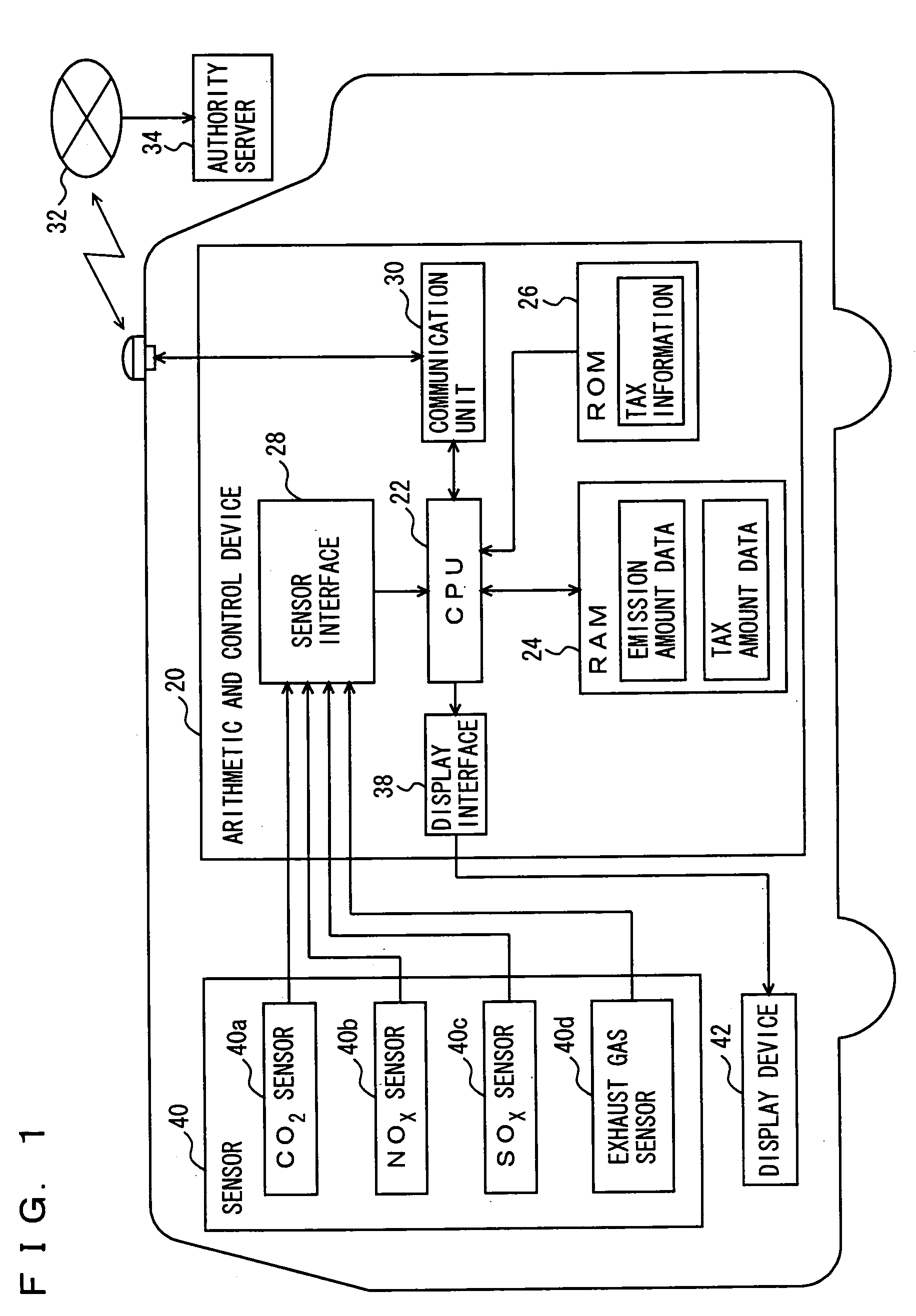

Emission amount report device, system for charge for exhaust gas from vehicle, management unit and inspection device making up the system

InactiveUS20050173523A1Sure easyIncrease volumeTicket-issuing apparatusInternal combustion piston enginesHydrocotyle bowlesioidesHazardous substance

For improving driver's awareness about emissions and promoting environmental protection, an emission amount notifying device is provided. When such a taxation system becomes effective that a tax is imposed in accordance with an amount of one or more kinds of harmful substances, which include a carbon dioxide, nitrogen oxides, sulphur oxides and hydrocarbons emitted from a vehicle, a sensor determines the emission amounts of respective harmful substances, and a CPU obtains the amount of tax corresponding to the determined emission amounts from a ROM storing tax information related to the tax amounts corresponding to respective displacements, and displays the obtained tax amount on a display device. Further, the CPU sends the information relating to the determined emission amount to a server of authorities from a communication unit for performing tax payment procedures.

Owner:SUMITOMO ELECTRIC IND LTD

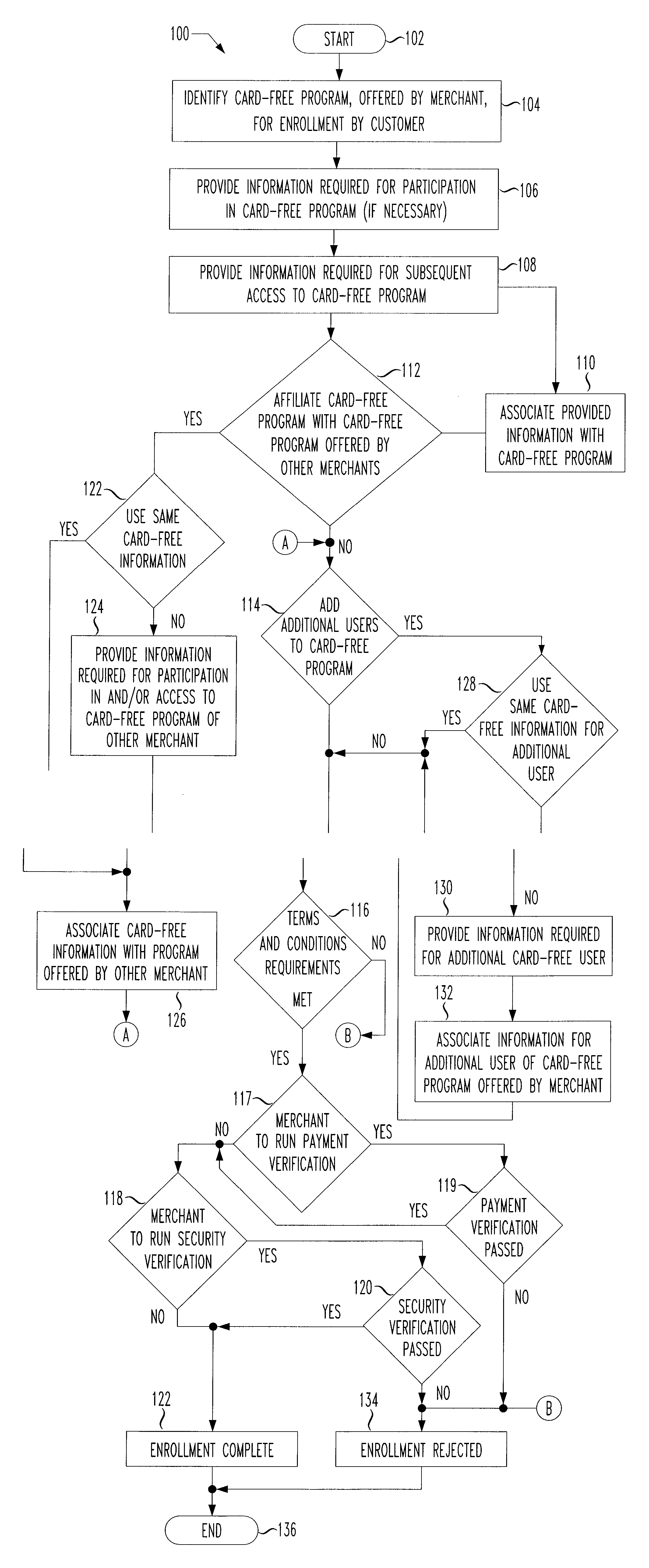

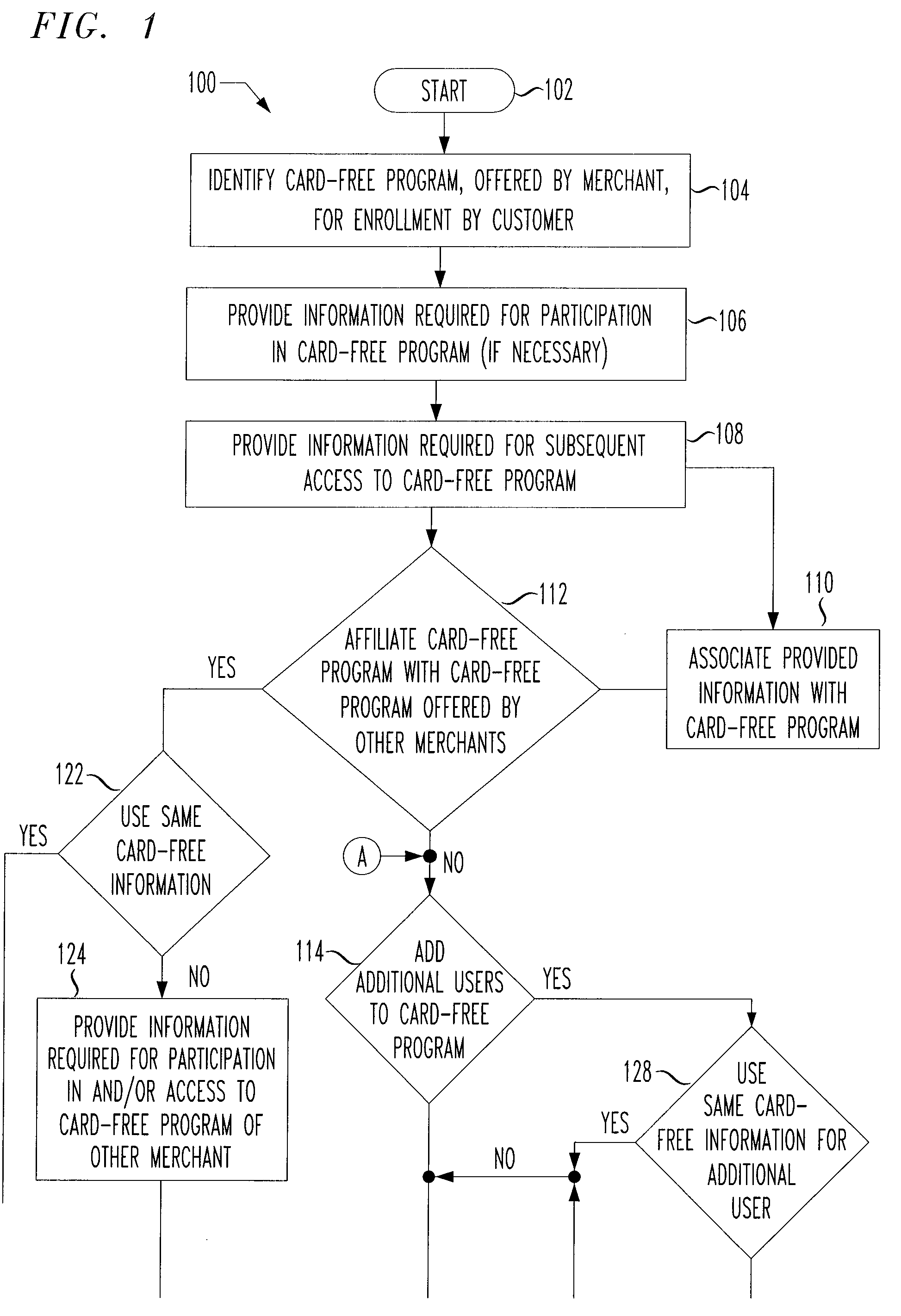

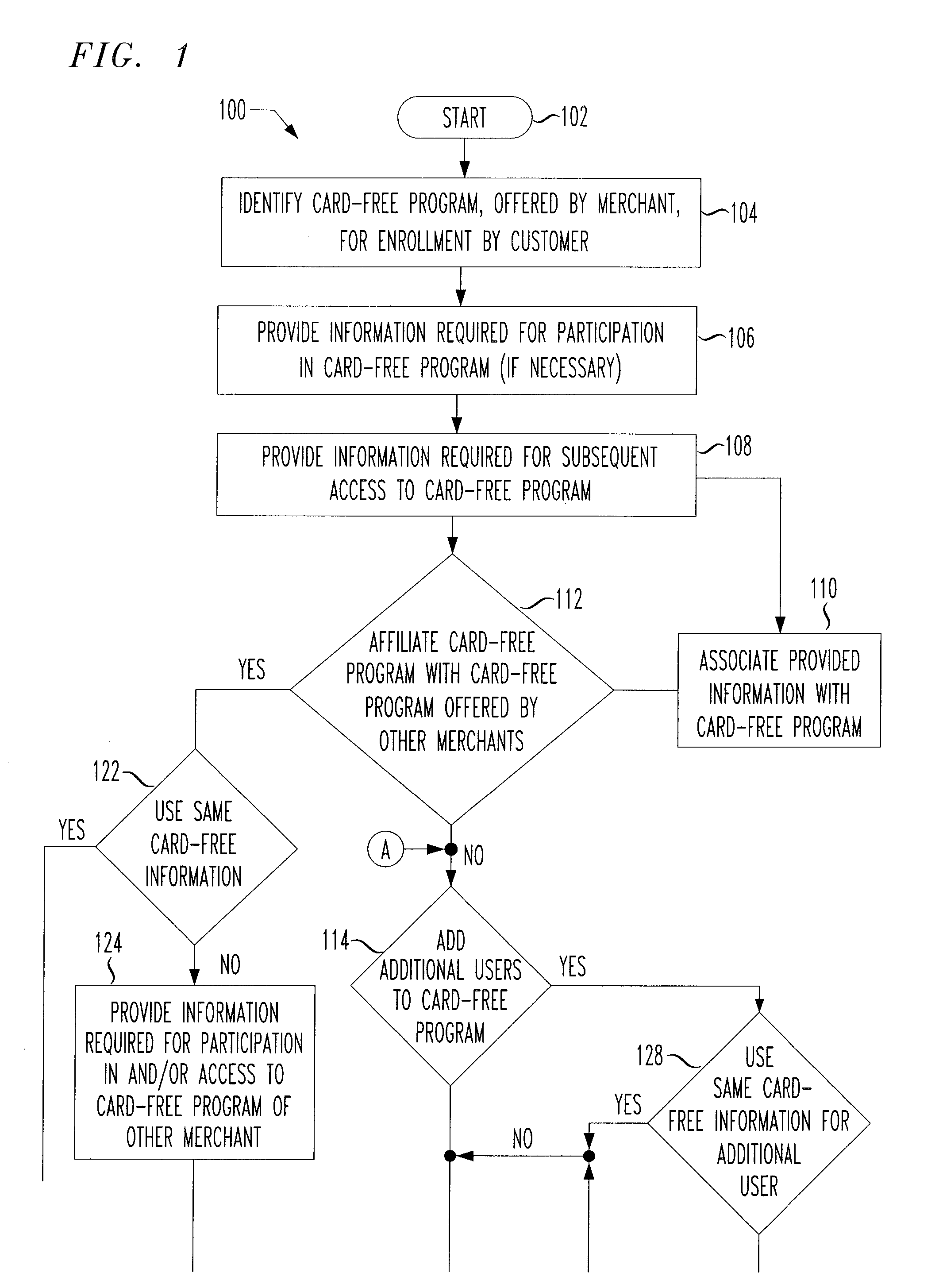

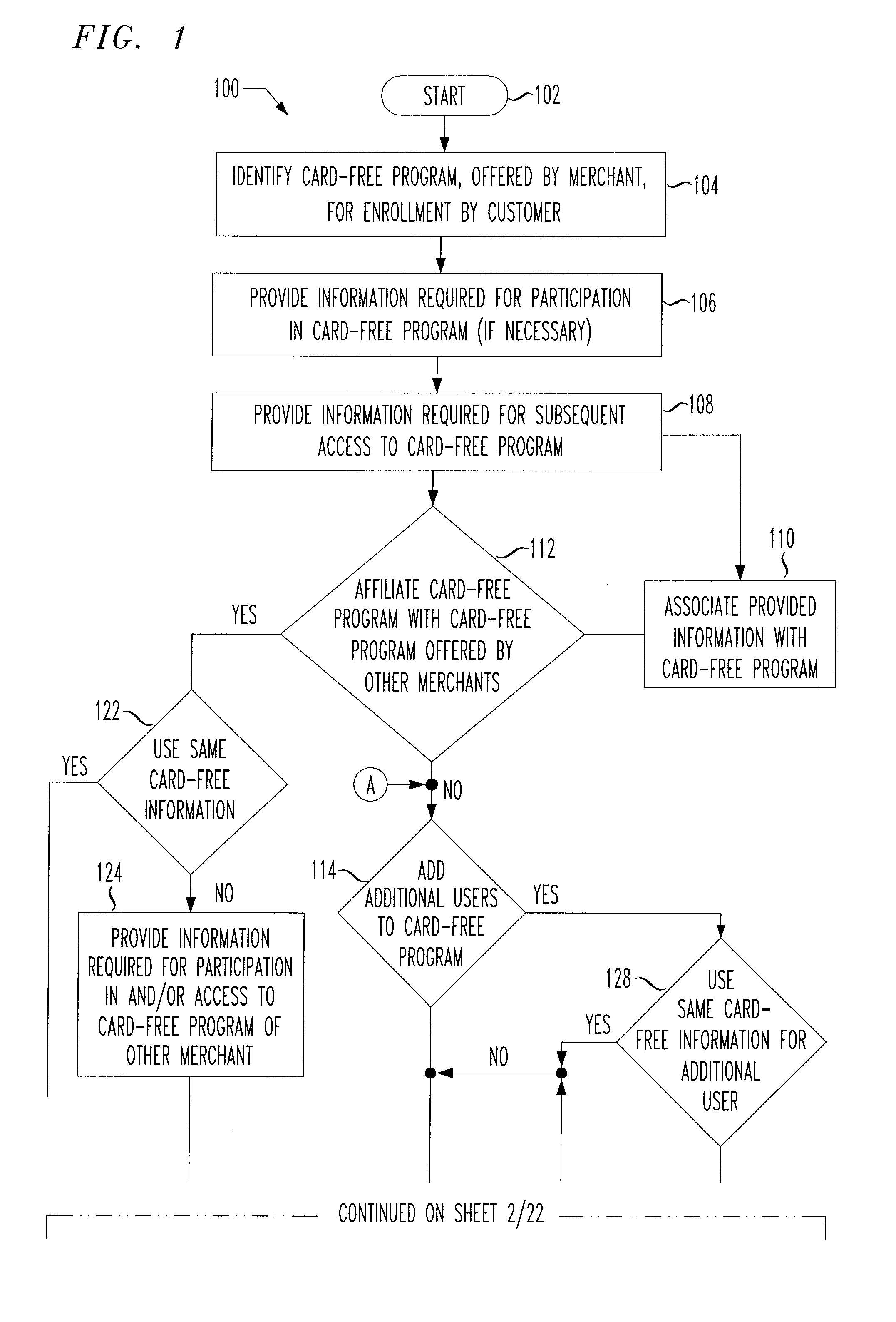

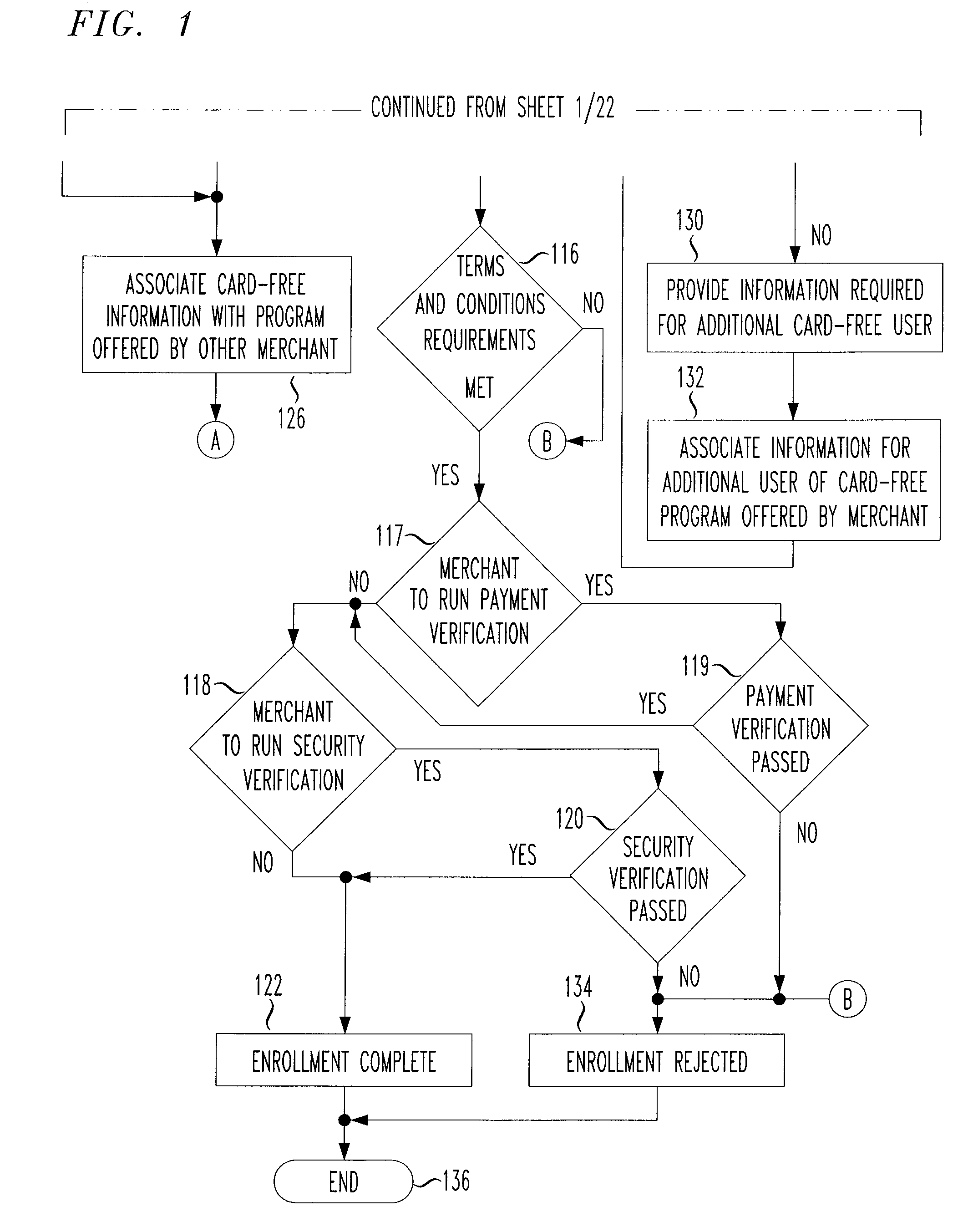

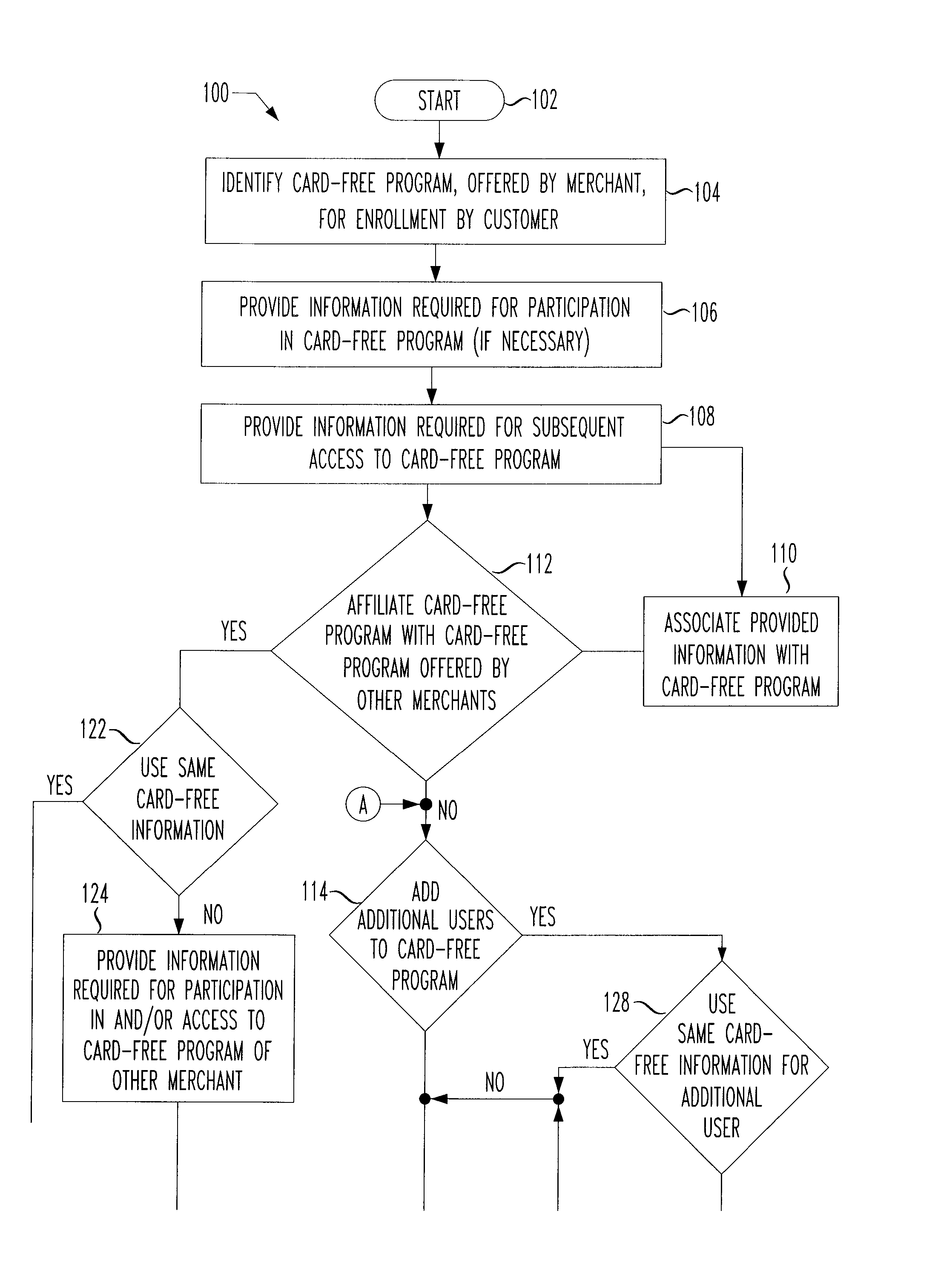

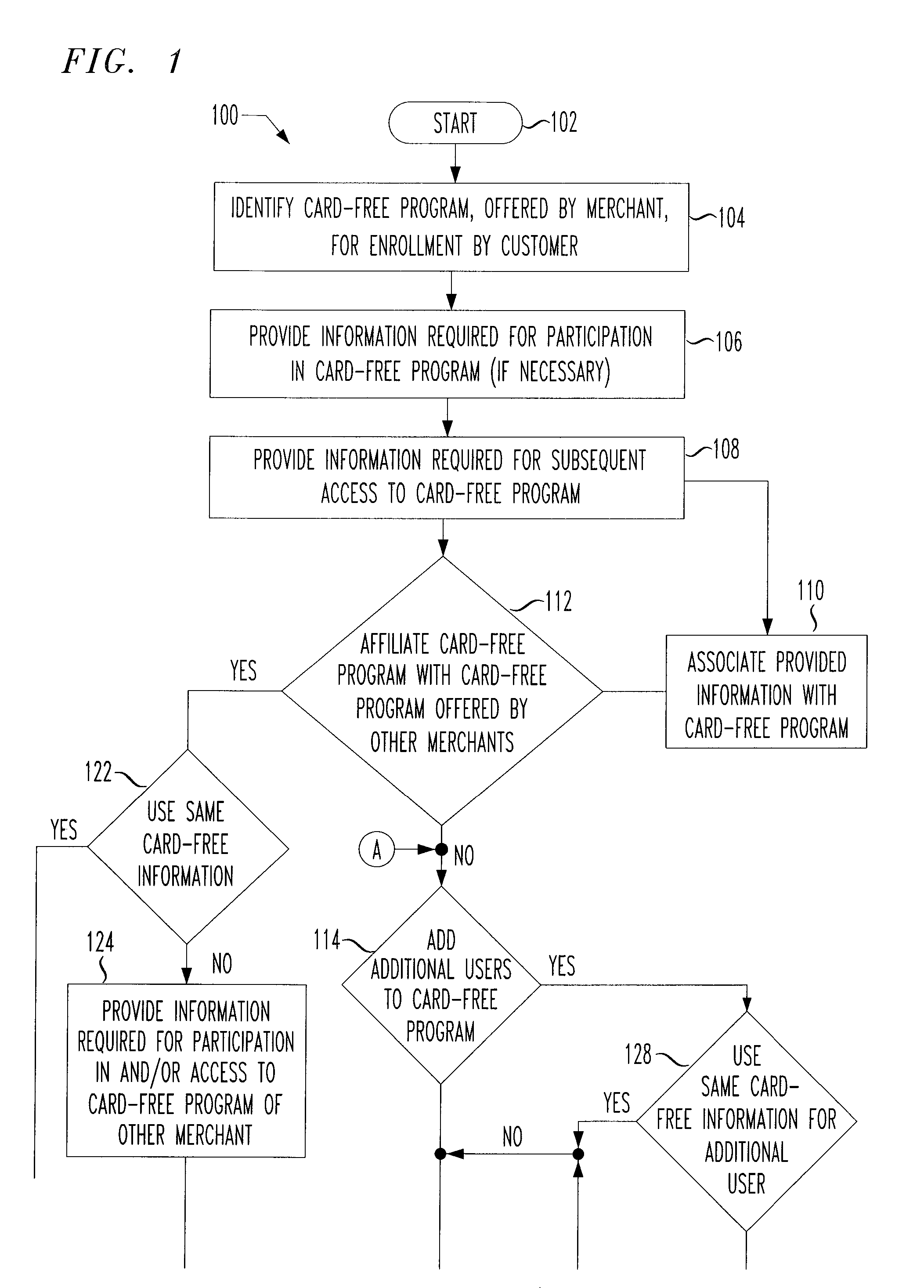

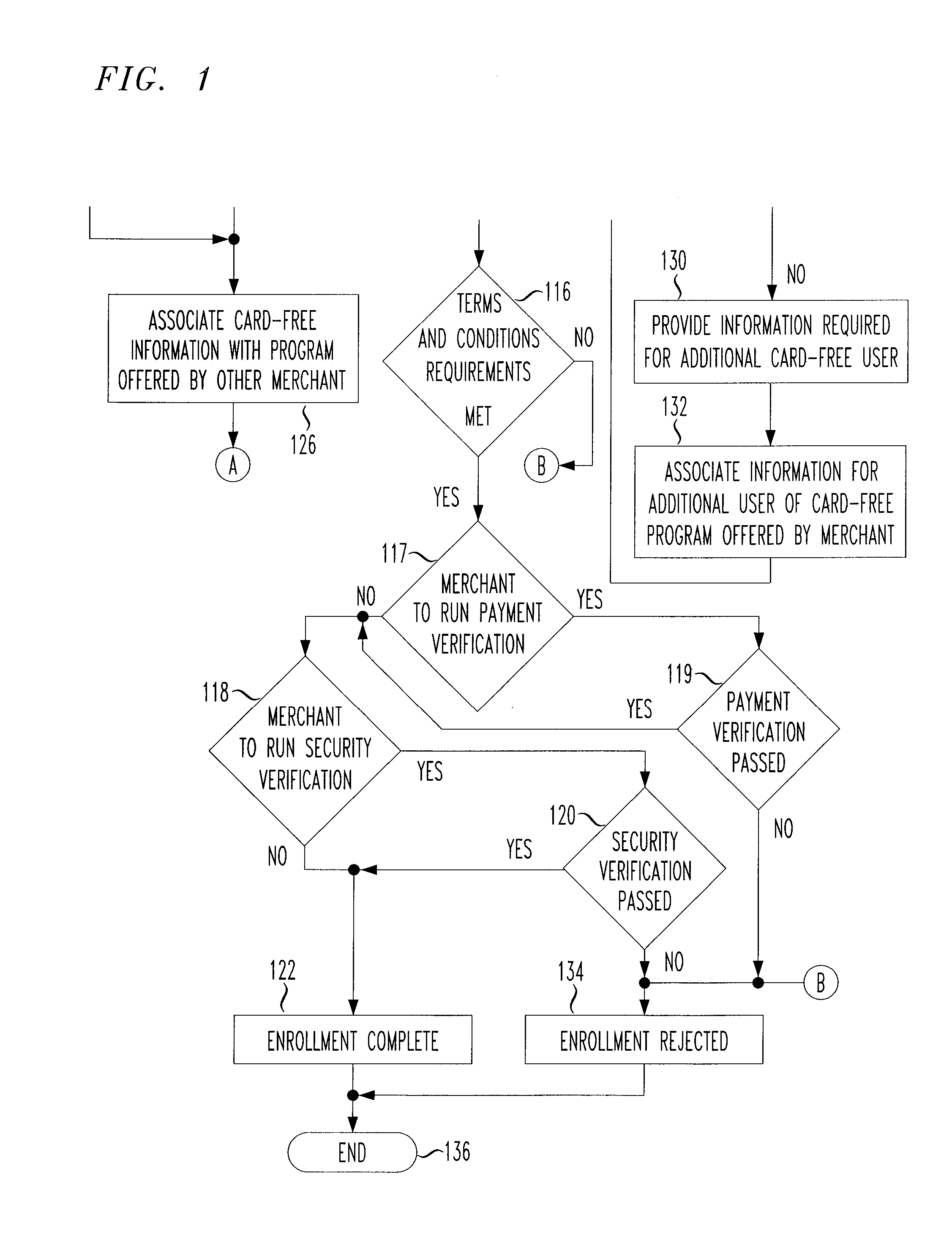

Payment program for use in point-of-sale transactions

ActiveUS20070022048A1Easy to rememberSuitable for useDiscounts/incentivesFinanceComputer hardwareBiometric data

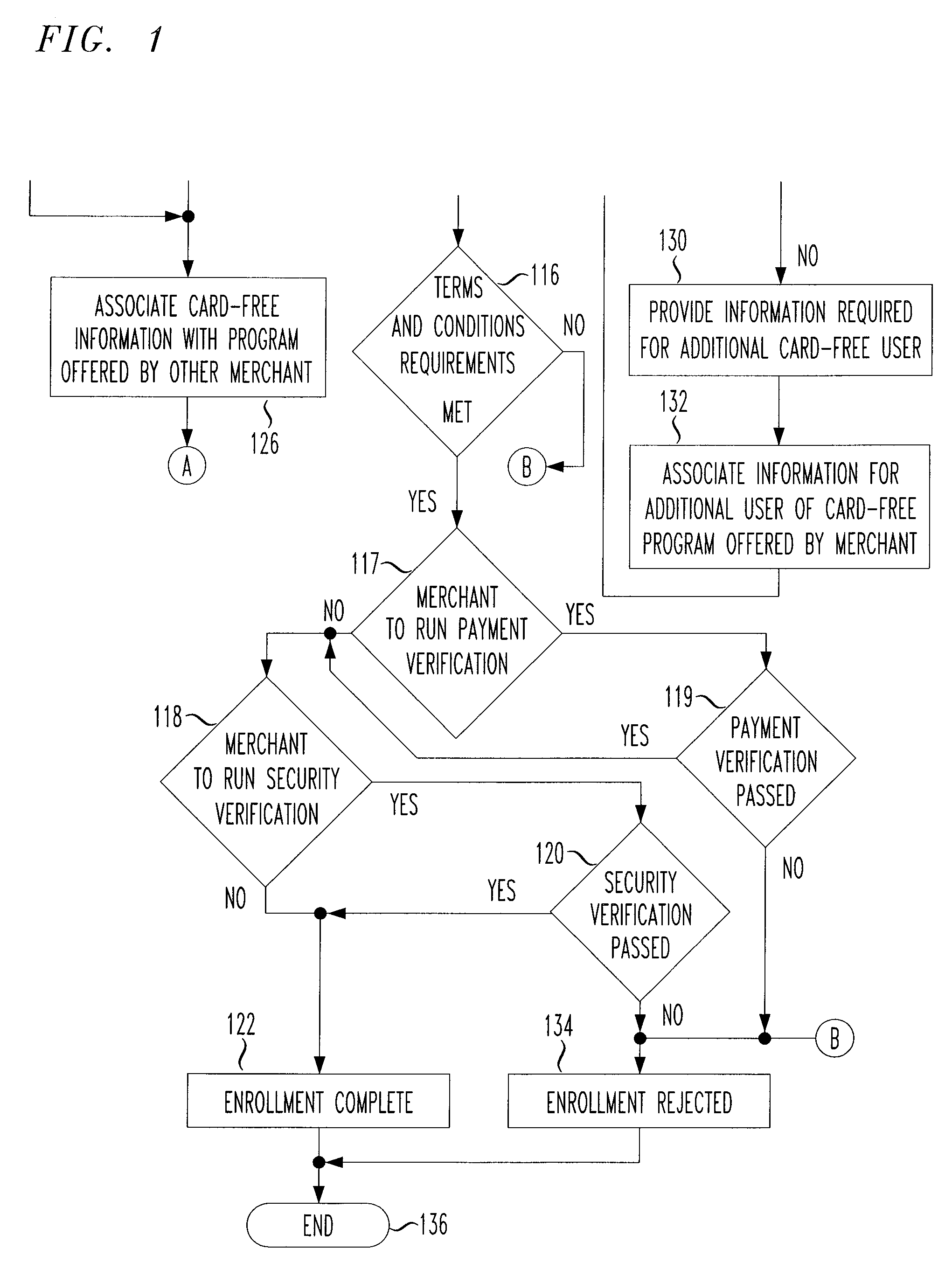

In some embodiments, the present application relates to card-free programs provided by a merchant to a customer, whereby the customer has access to functions such as payment options and / or loyalty program benefits without needing to present a physical card at a point of sale. For example, a customer may make a card-free purchase of goods or services from a merchant, whereby the customer need not present a card such as a debit card, credit card, loyalty card, or other physical tender to make a purchase. Further, the customer need not provide biometric data or otherwise use an electronic device or identifier to make a purchase. Alternatively or additionally, the customer may access a loyalty program without needing to provide a physical card or data associated with a card.

Owner:SAFEWAY INC

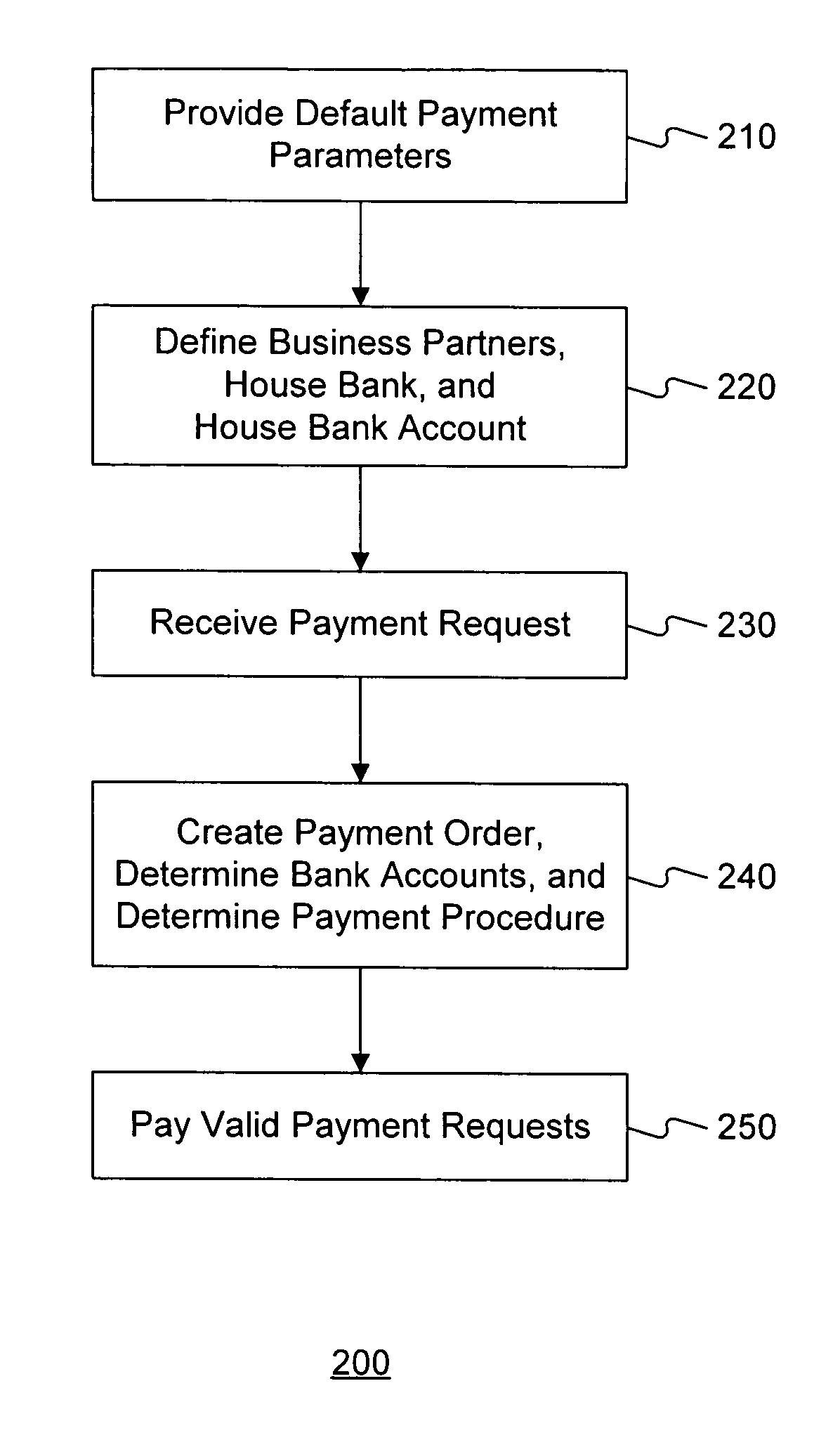

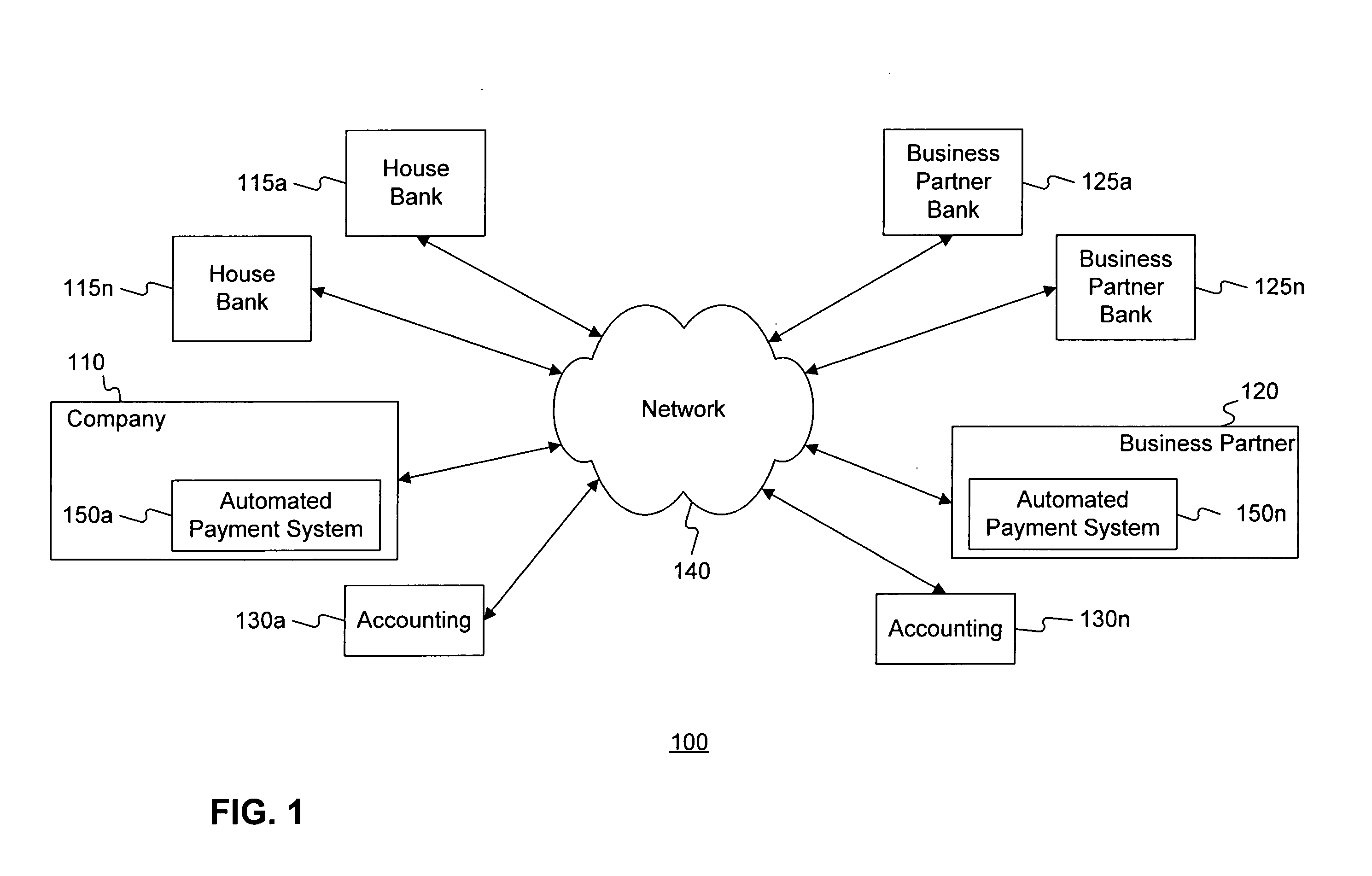

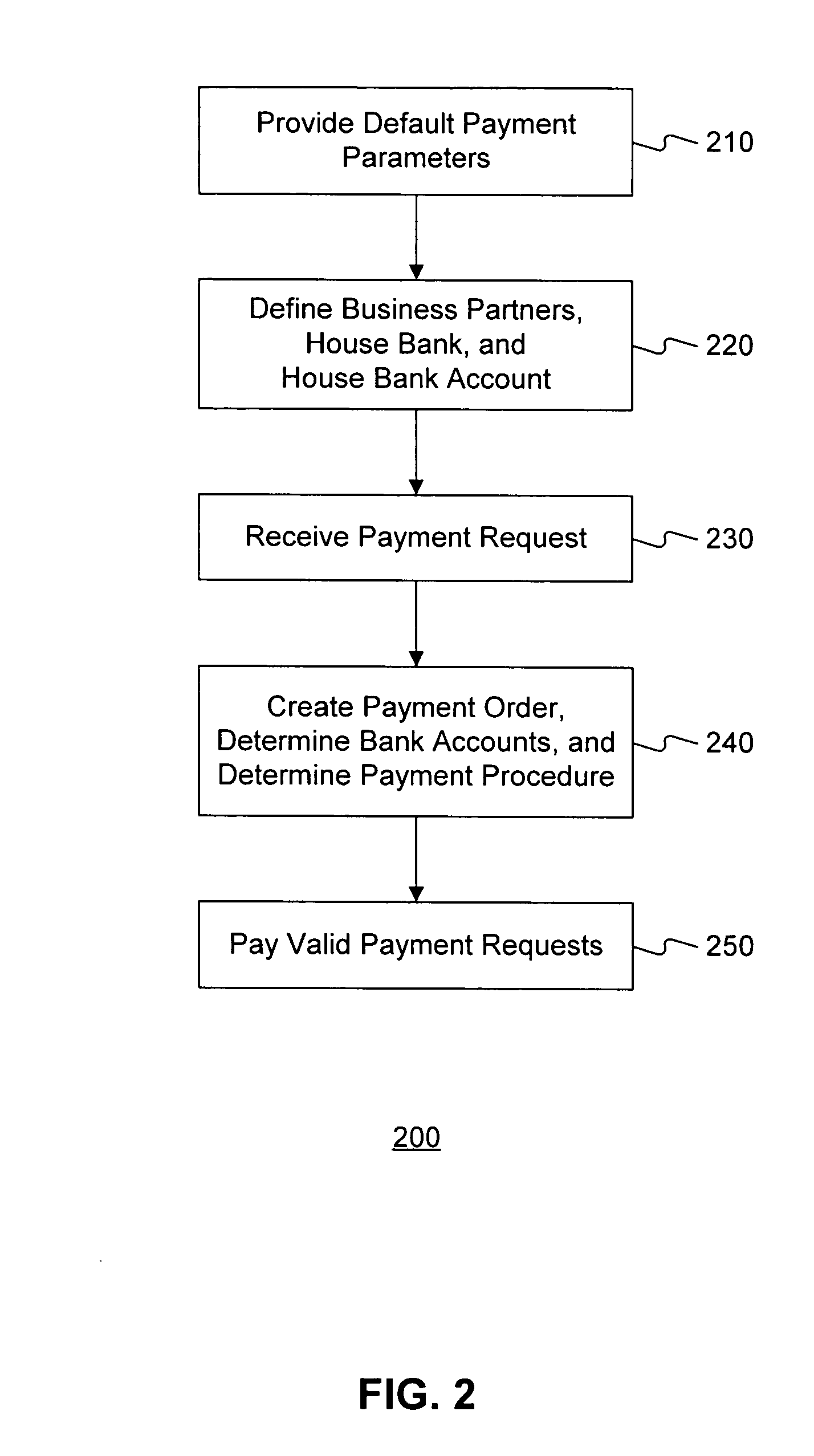

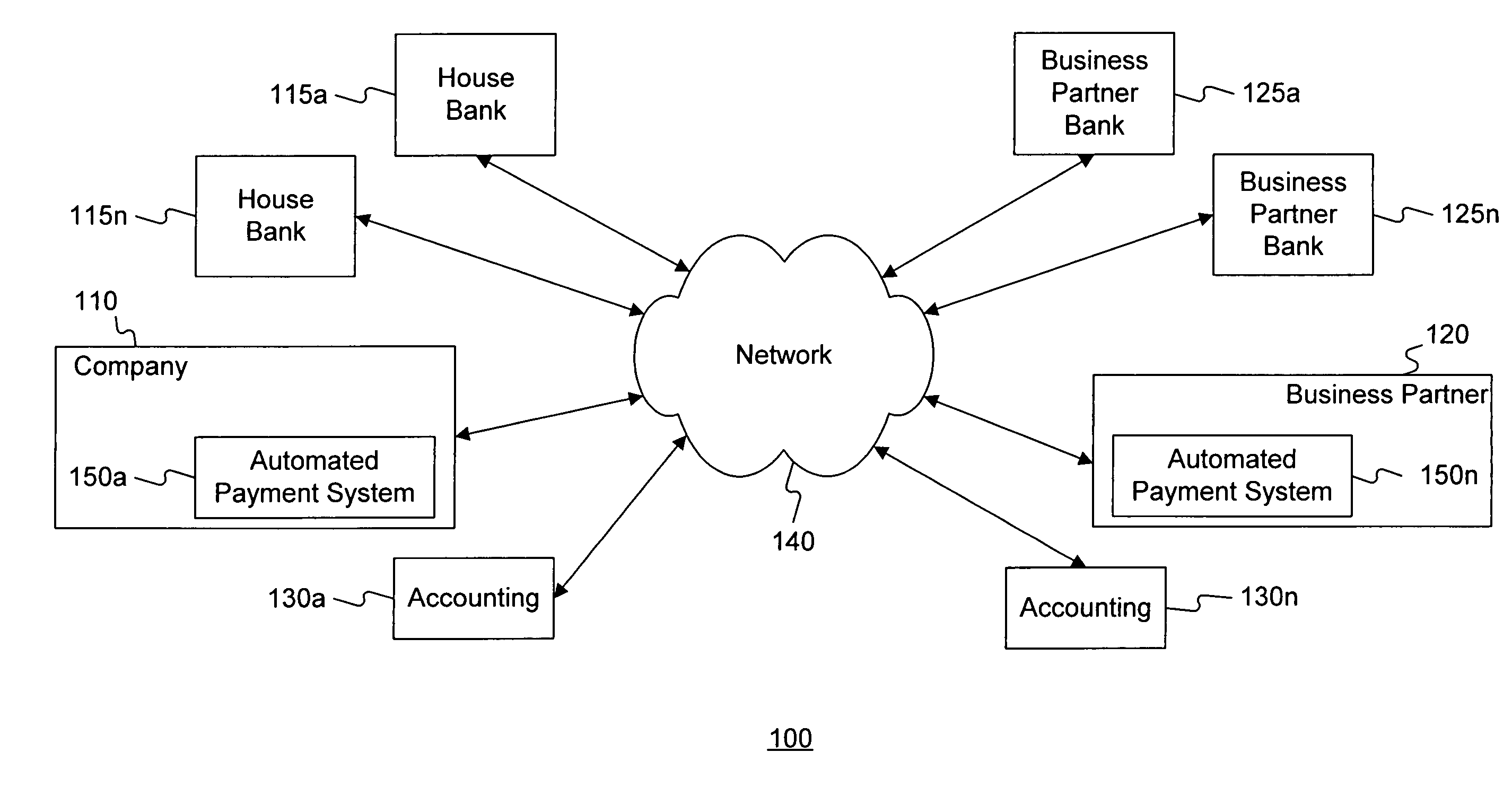

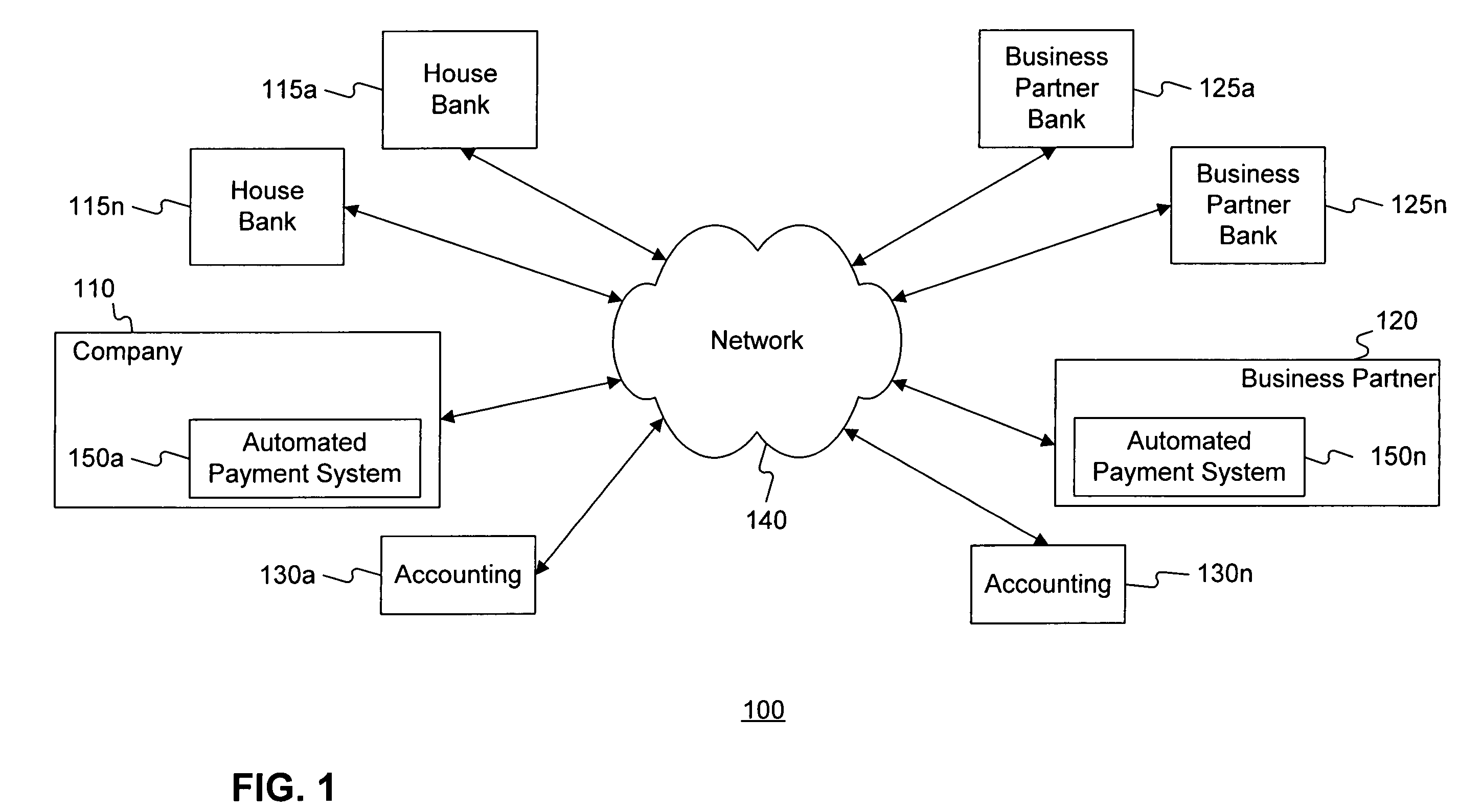

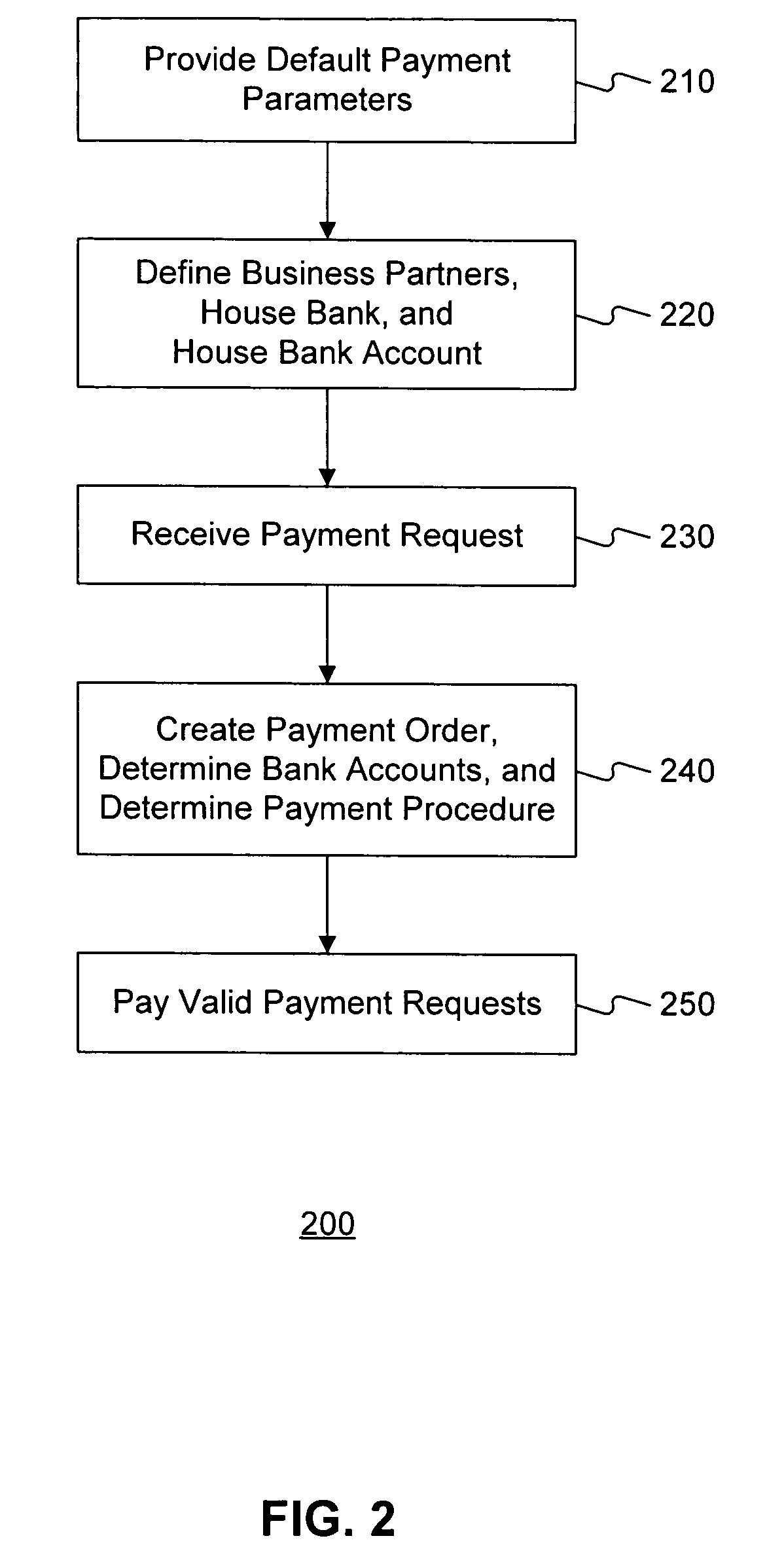

Systems and methods for bank determination and payment handling

Systems and methods are provided for automated payment handling. In one implementation, a method is provided for processing of a payment request. The method may include determining, using the payment request, an entity that will receive a payment, and determining an outgoing bank account to use for the payment. Further, the method may include automatically selecting, from a list of available payment procedures, a preferred payment procedure for the payment request, the preferred payment procedure indicating a payment form code and a connection with the entity. Moreover, the method may include validating the preferred payment procedure using a set of rules and paying, to the entity, the payment using the validated payment procedure.

Owner:SAP AG

Payment program for use in point-of-sale transactions

In some embodiments, the present application relates to card-free programs provided by a merchant to a customer, whereby the customer has access to functions such as payment options and / or loyalty program benefits without needing to present a physical card at a point of sale. For example, a customer may make a card-free purchase of goods or services from a merchant, whereby the customer need not present a card such as a debit card, credit card, loyalty card, or other physical tender to make a purchase. Further, the customer need not provide biometric data or otherwise use an electronic device or identifier to make a purchase. Alternatively or additionally, the customer may access a loyalty program without needing to provide a physical card or data associated with a card.

Owner:SAFEWAY INC

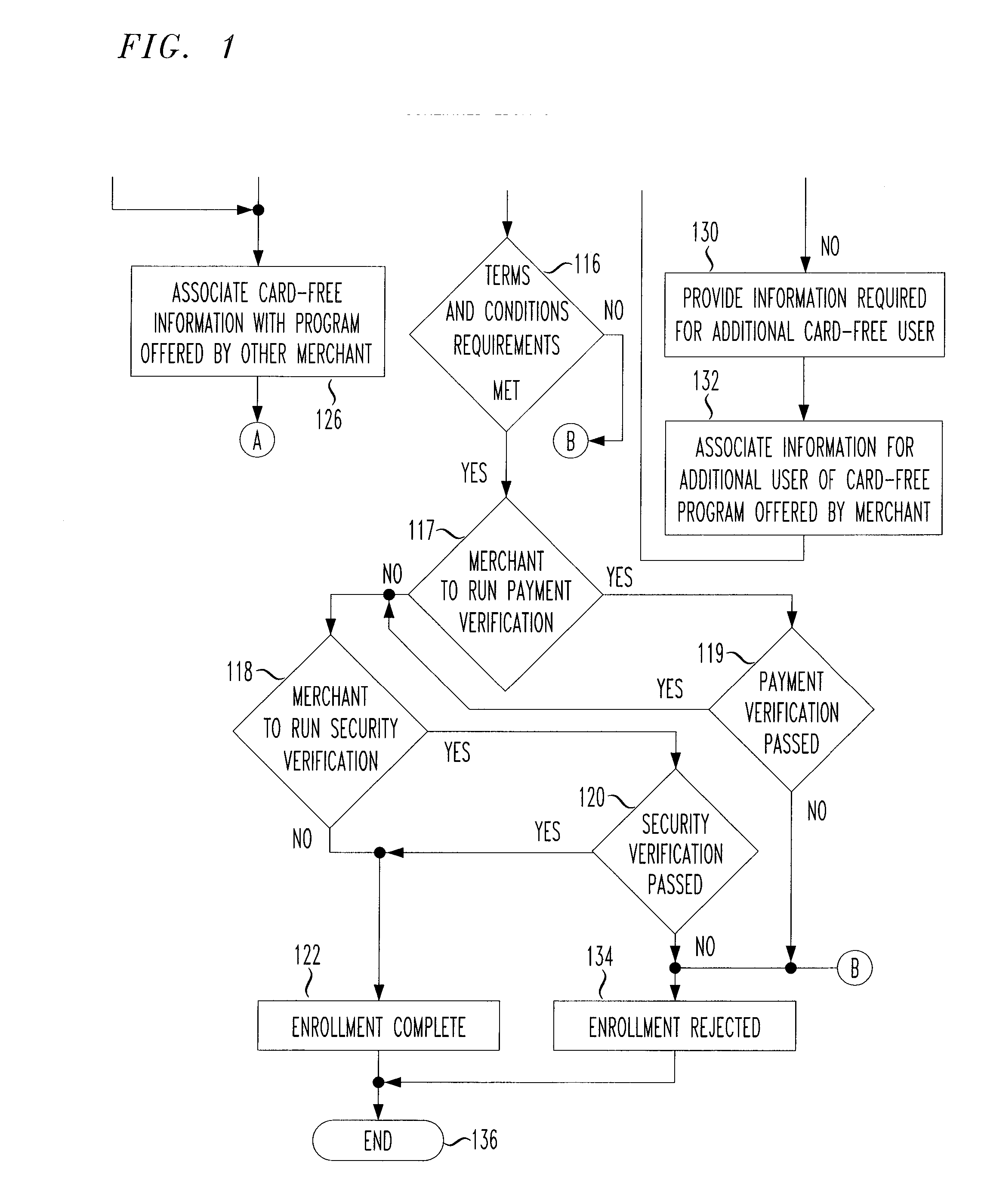

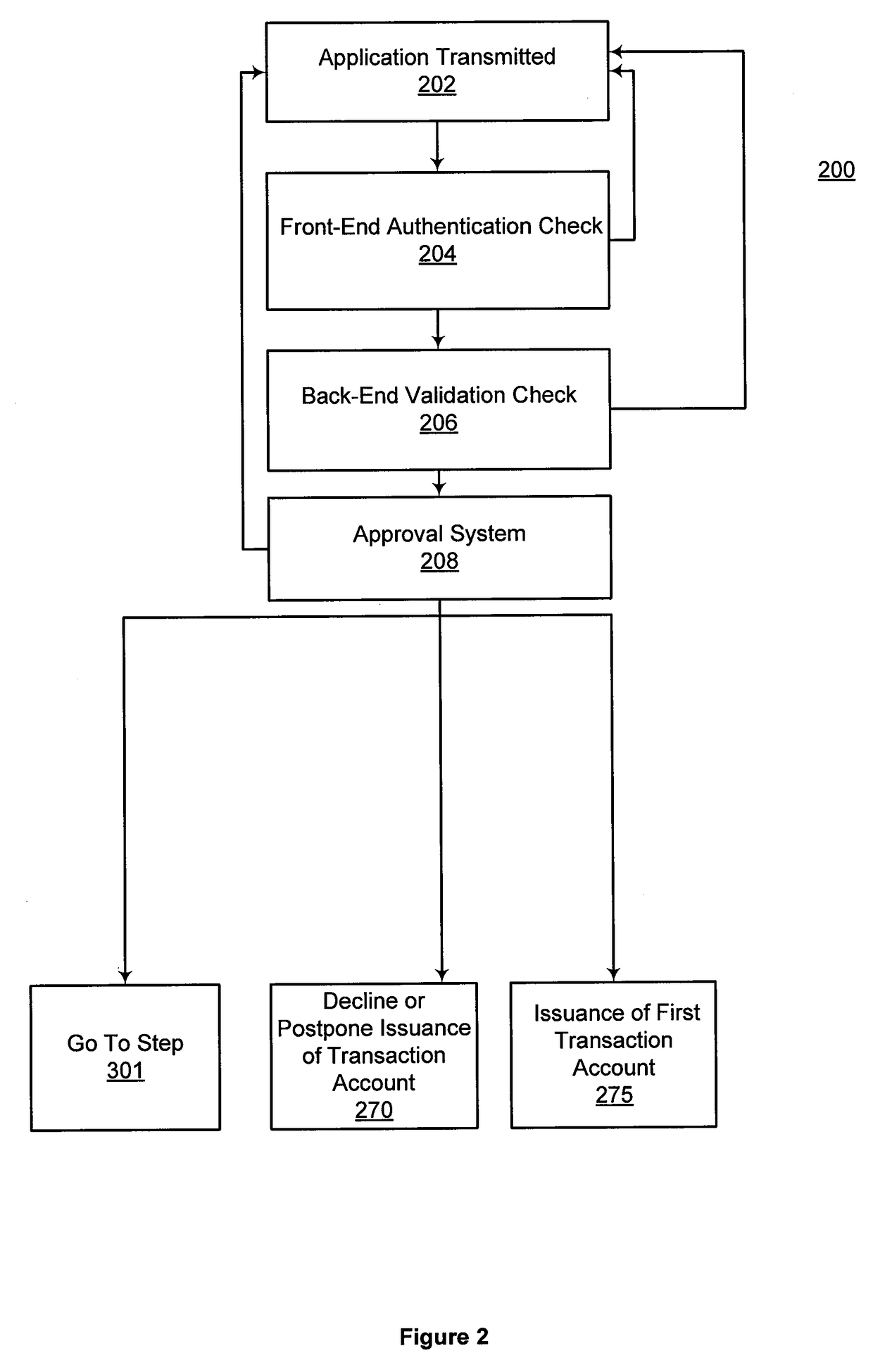

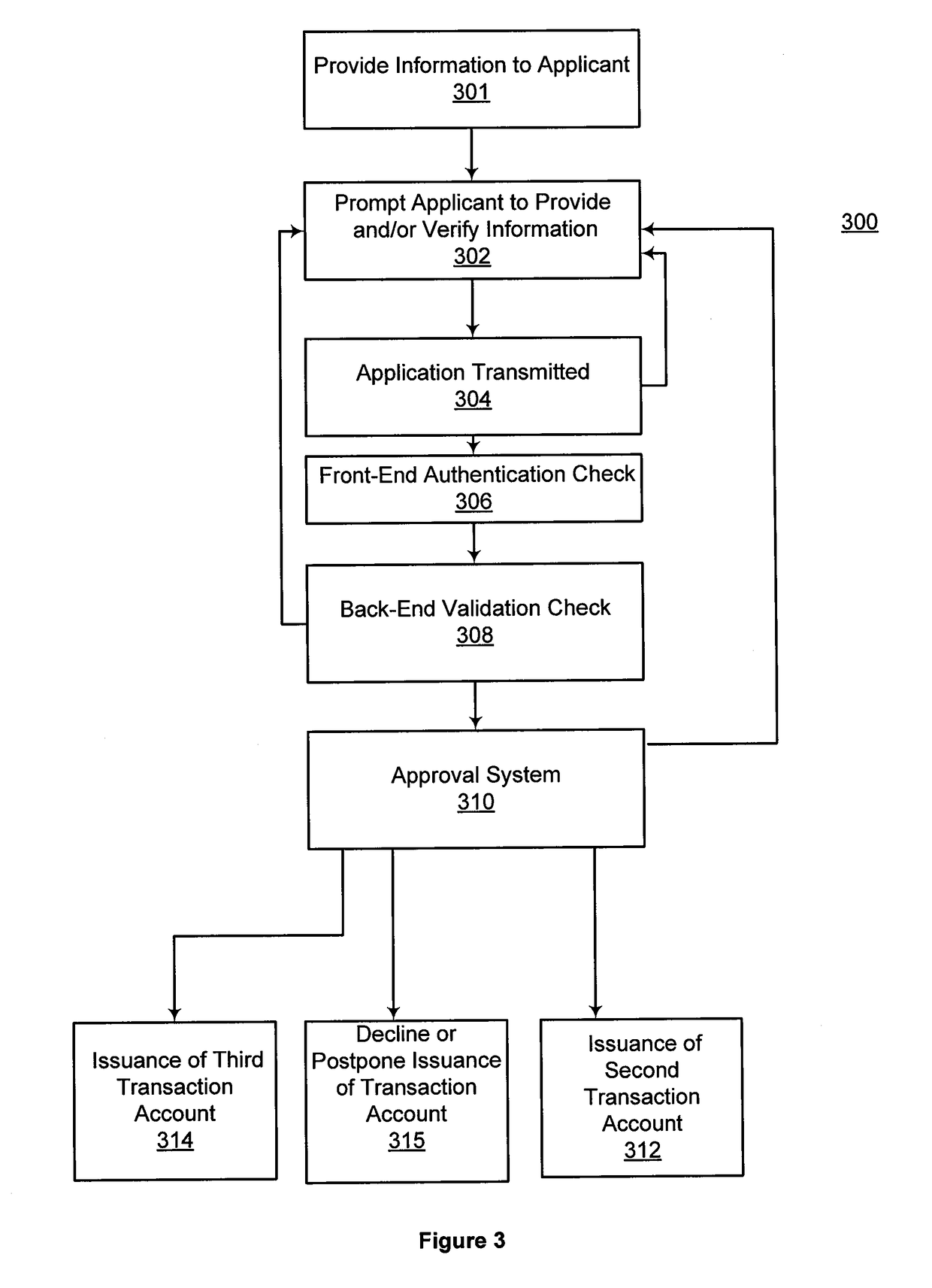

System, method, and computer program product for issuing automatic payments linked transaction account

InactiveUS8473394B2Facilitate increasing an individual's credit scoreEasy constructionFinanceCommerceDatabaseTransaction account

An enrolling system verifies an enrollee, counter-offers a second transaction account in response to a decline of a first account, wherein the second transaction account includes more restrictions than a first transaction account, associates an enrollee's main and overdraft account, and issues a transaction account. Enrolling in the second transaction account may include enrolling in a second transaction account automatic payment program; and / or associating a demand deposit account to the second transaction account. The method may also include relaxing use restrictions of the transaction account based upon at least one of: receiving payment of a pre-selected amount, receiving payments over a pre-selected period, and receiving payment on or before a pre-selected date.

Owner:LIBERTY PEAK VENTURES LLC

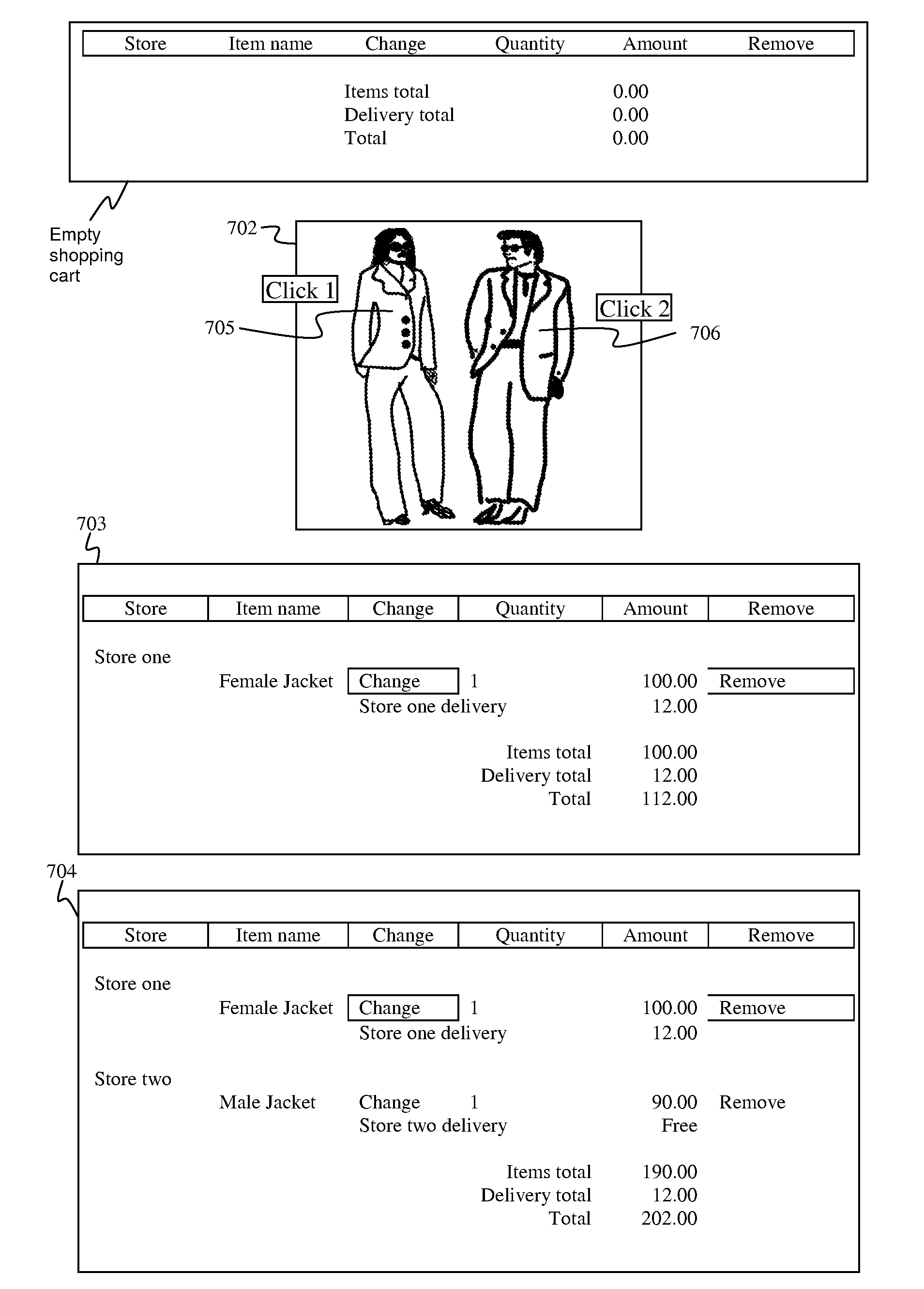

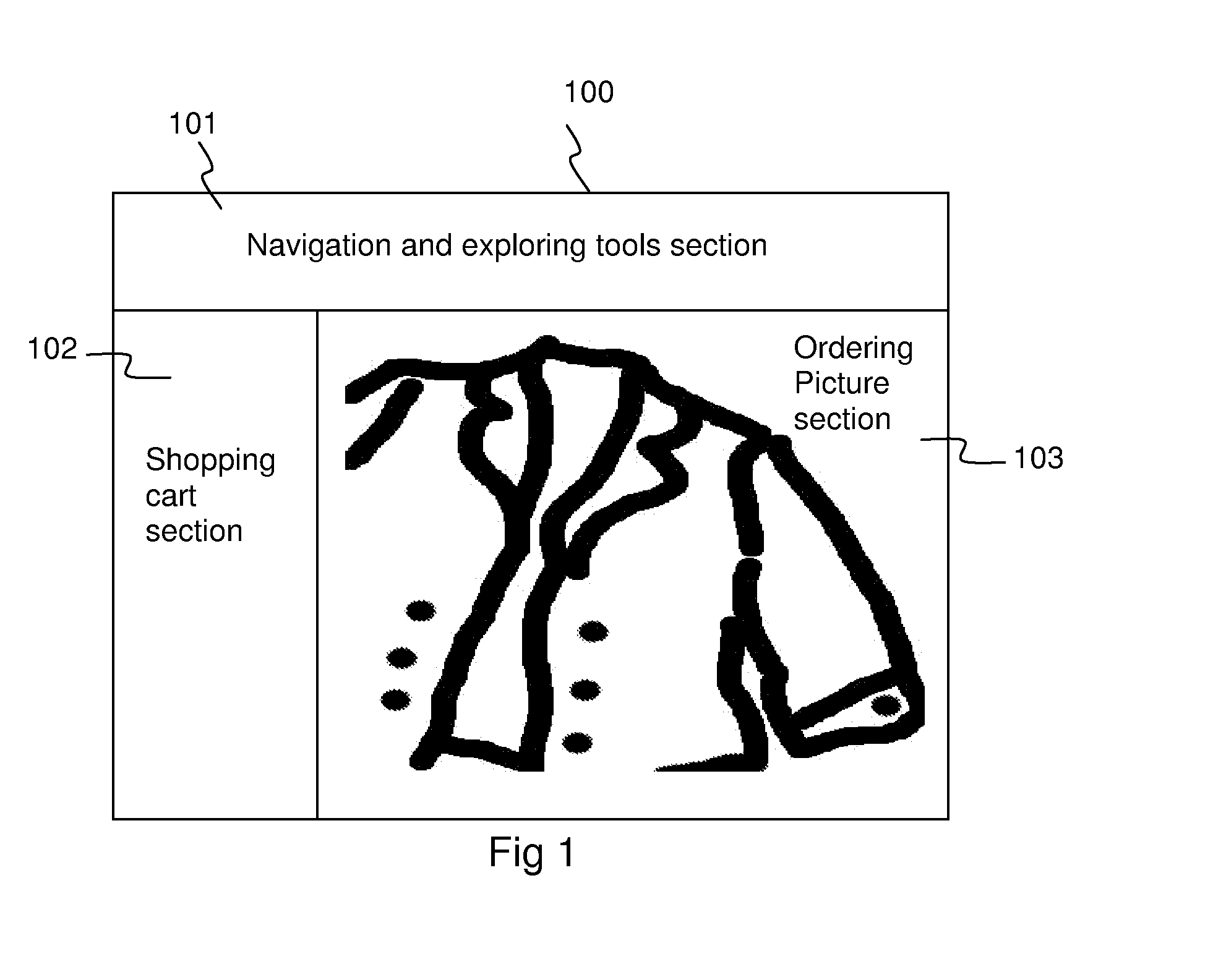

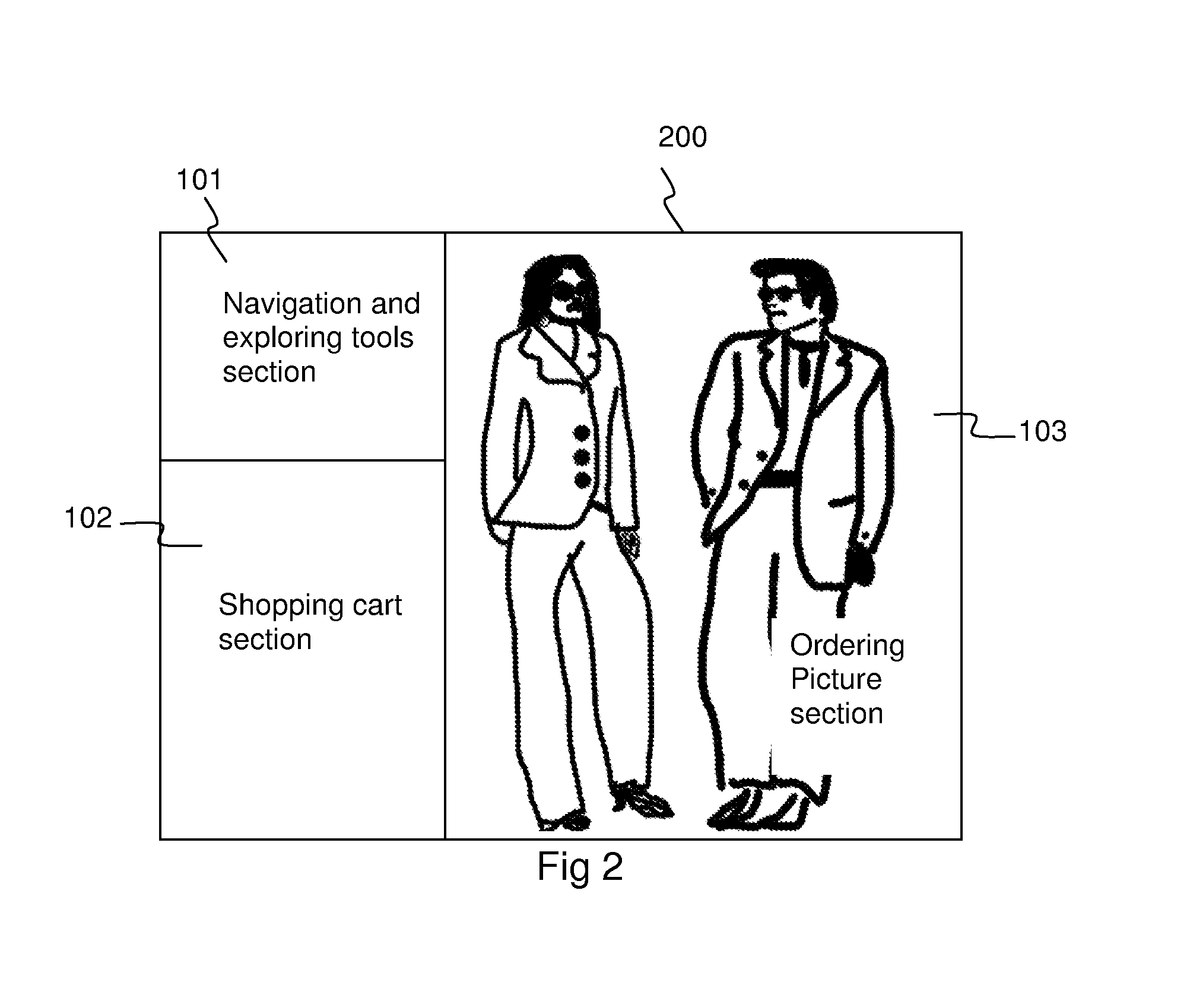

Efficiency of E commerce shopping from a picture or motion picture on the Internet

ActiveUS20070271156A1Improve shopping experienceCommerceSpecial data processing applicationsInformation controlWeb site

A method and apparatus for adding items / services / sales to a shopping cart directly from a static or moving picture while maintaining single user interface which includes all site navigating and information controls, shopping cart and items complementary information frames. The picture can combine multiple products from various merchants, promotional advertisements and sale attractions. The method further defines a ways to add items / sales / services that needs user interaction into the shopping cart. It further defines ways to add multi vendor items into the shopping cart. It further defines ways to handle and add sales / promotions messages items / services / sales to shopping cart while updating shopping cart according to sales / promotions conditions. Method further defines ways to define personal items catalogs and preferred sale catalogs based on the said adding item to a shopping cart. Method further defines payment procedures that allow completing an order from the said shopping cart using localized payment cards / coupons / promotion codes / web-site links and the like payments options. Method further defines ways to share users rankings / preferences.

Owner:SARUSI SHLOMIT +1

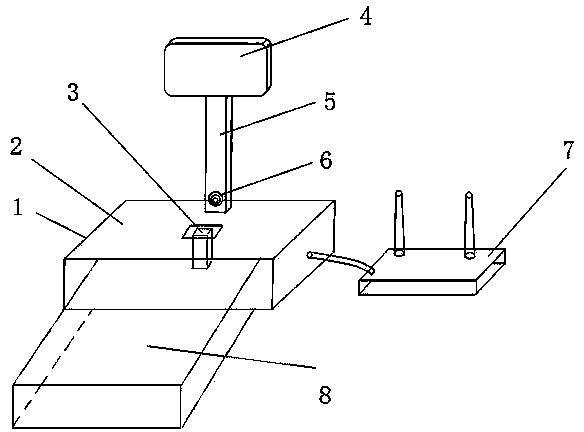

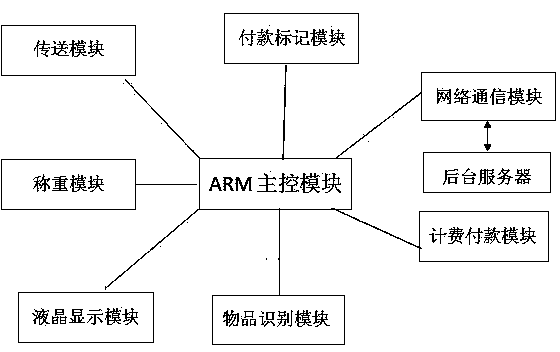

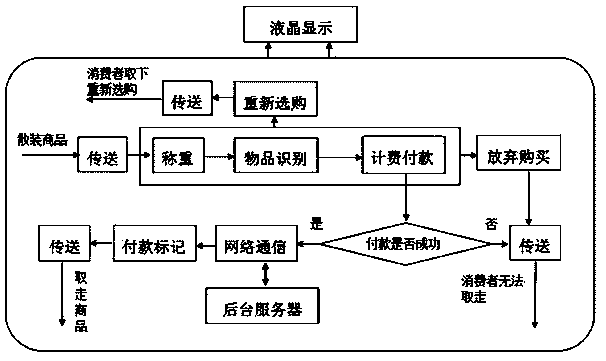

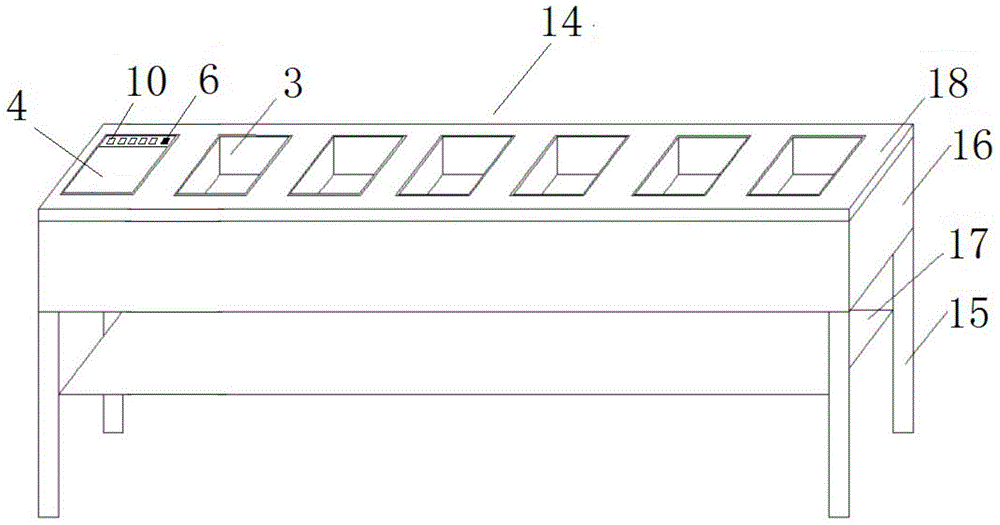

Intelligent shopping device for supermarket commodities in bulk

InactiveCN104240411AReduce labor costsReduce manufacturing costCash registersLiquid-crystal displayNetwork communication

The invention discloses an intelligent shopping device for supermarket commodities in bulk. The intelligent shopping device comprises a conveying module, a weighing module, a liquid crystal display module, a commodity recognition module, a master control module, a billing and payment module, a network communication module and a payment marking module, wherein the master control module is connected with the conveying module, the weighing module, the liquid crystal display module, the commodity recognition module, the billing and payment module, the network communication module and the payment marking module, and the network communication module is further connected with a background server. A method of the intelligent shopping device mainly comprises the conveying procedure, the weighing procedure, the commodity recognition procedure, the billing and payment procedure, the background database updating procedure and the payment marking procedure. According to the intelligent shopping device, the shopping process of the commodities in bulk is greatly simplified, a consumer can carry out shopping more conveniently due to the automatic shopping process, and human cost is reduced for a supermarket; the types of the commodities are intelligently recognized, pricing is more convenient to carry out, and no manual inference is needed; due to an NFC and code scanning payment mode, the consumer can pay more safely and more efficiently; the shopping process is intelligently prompted, and operation is easy to carry out.

Owner:NANJING INST OF TECH

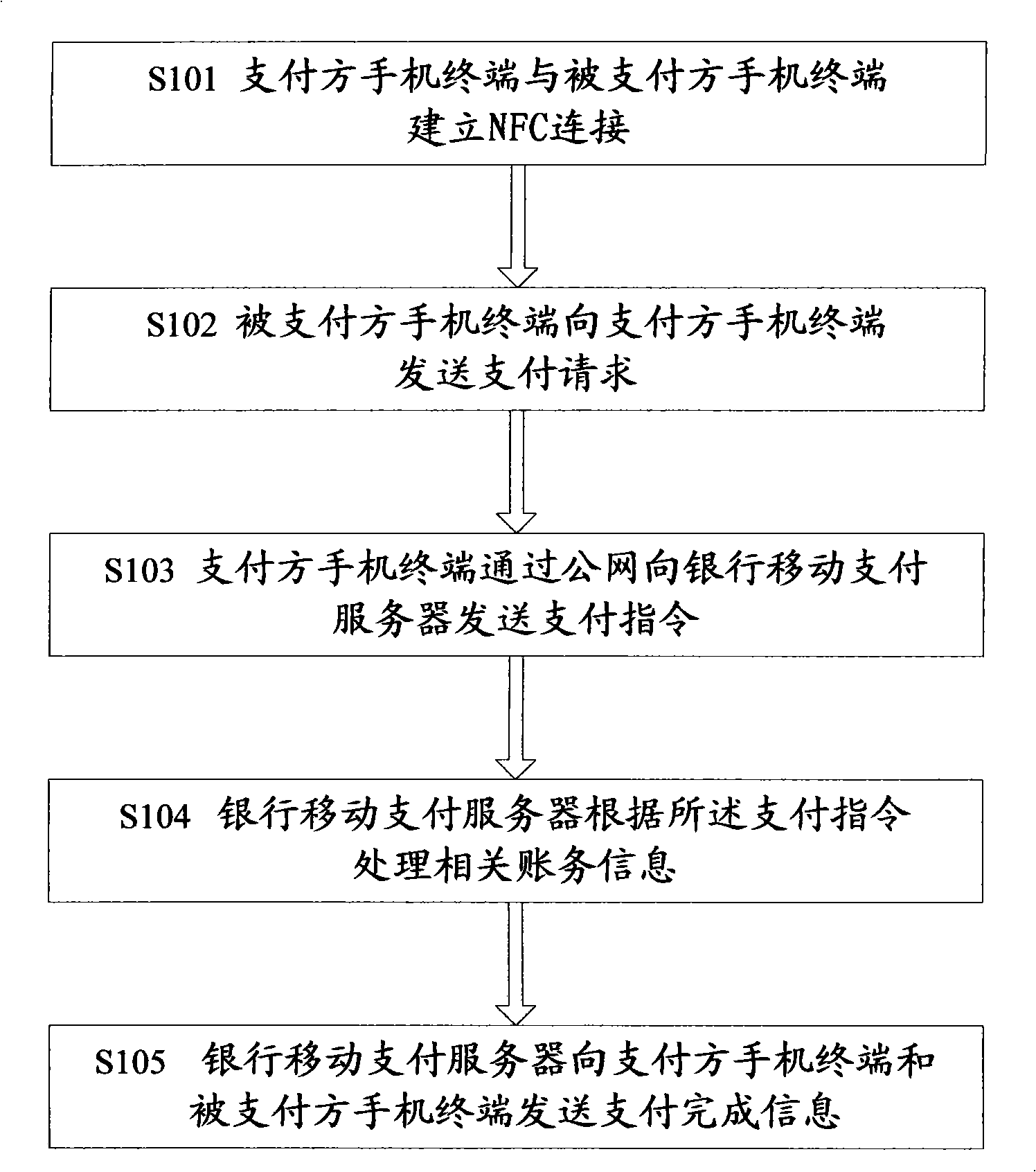

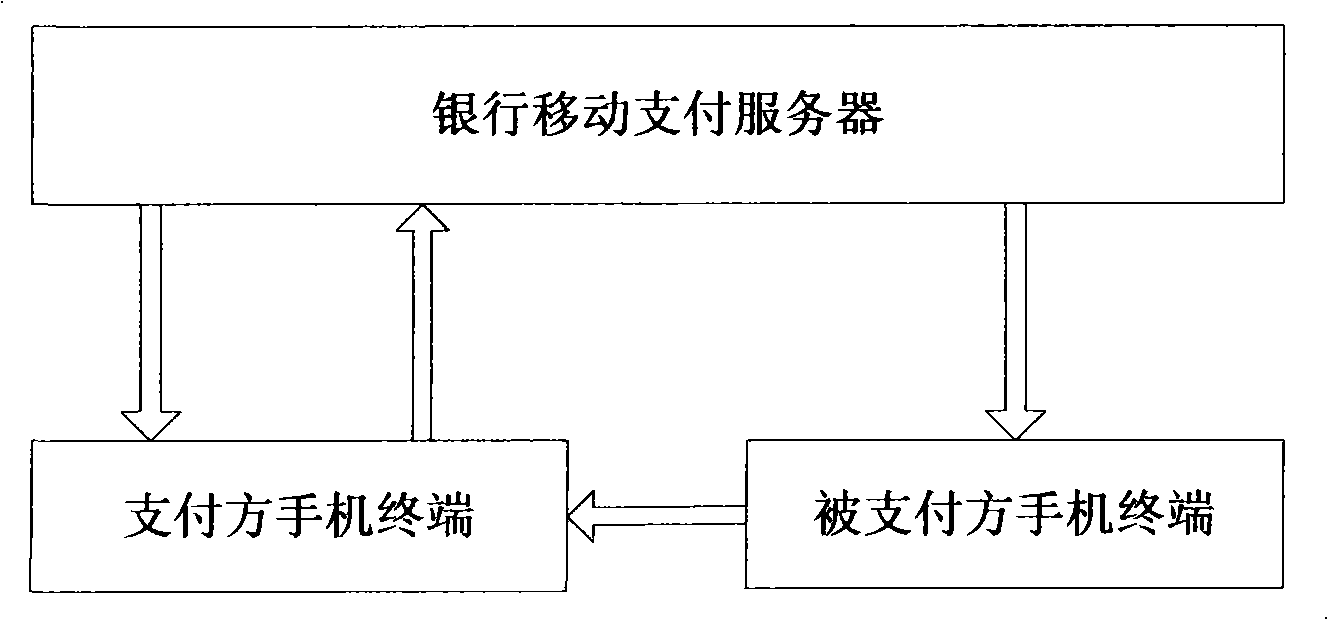

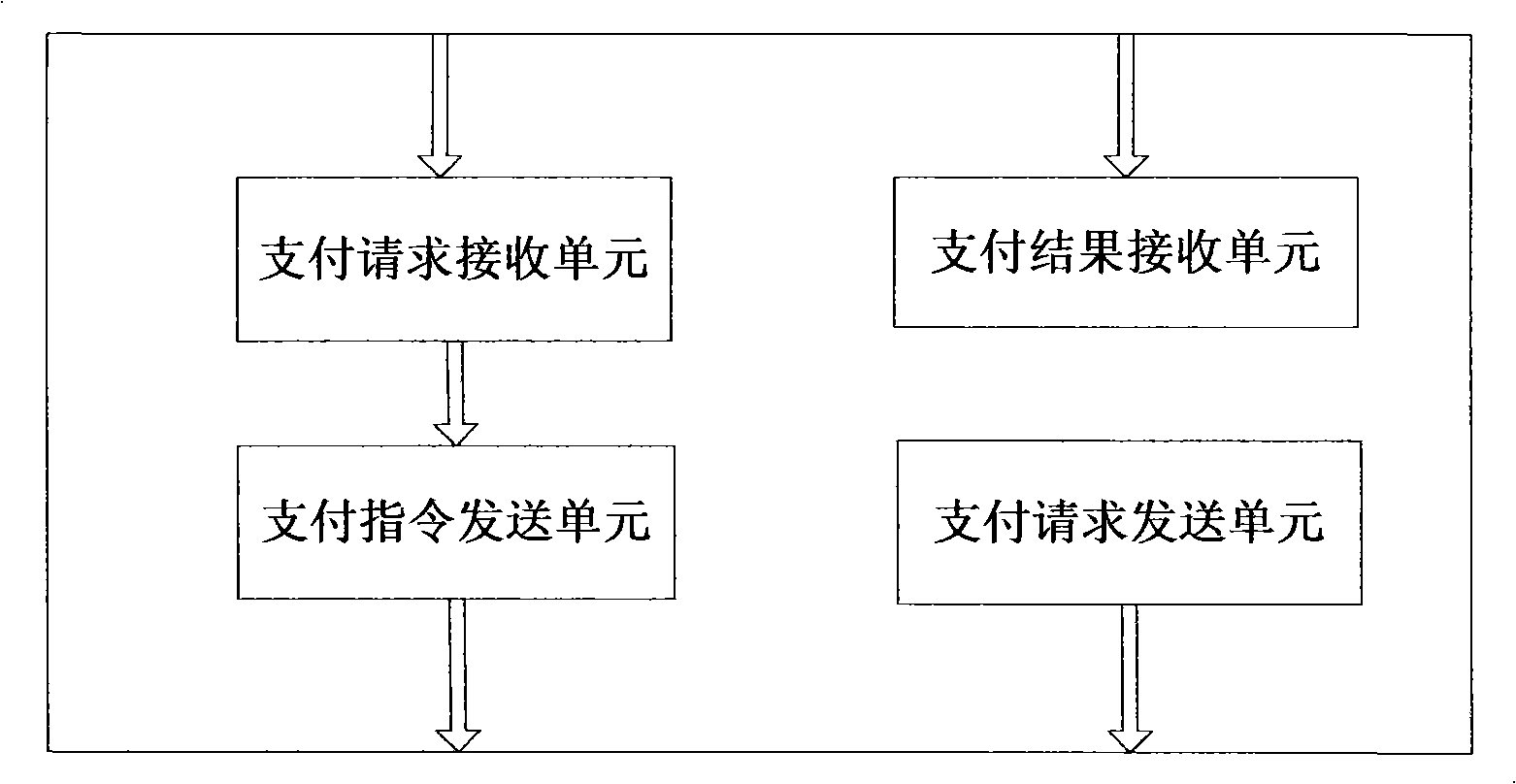

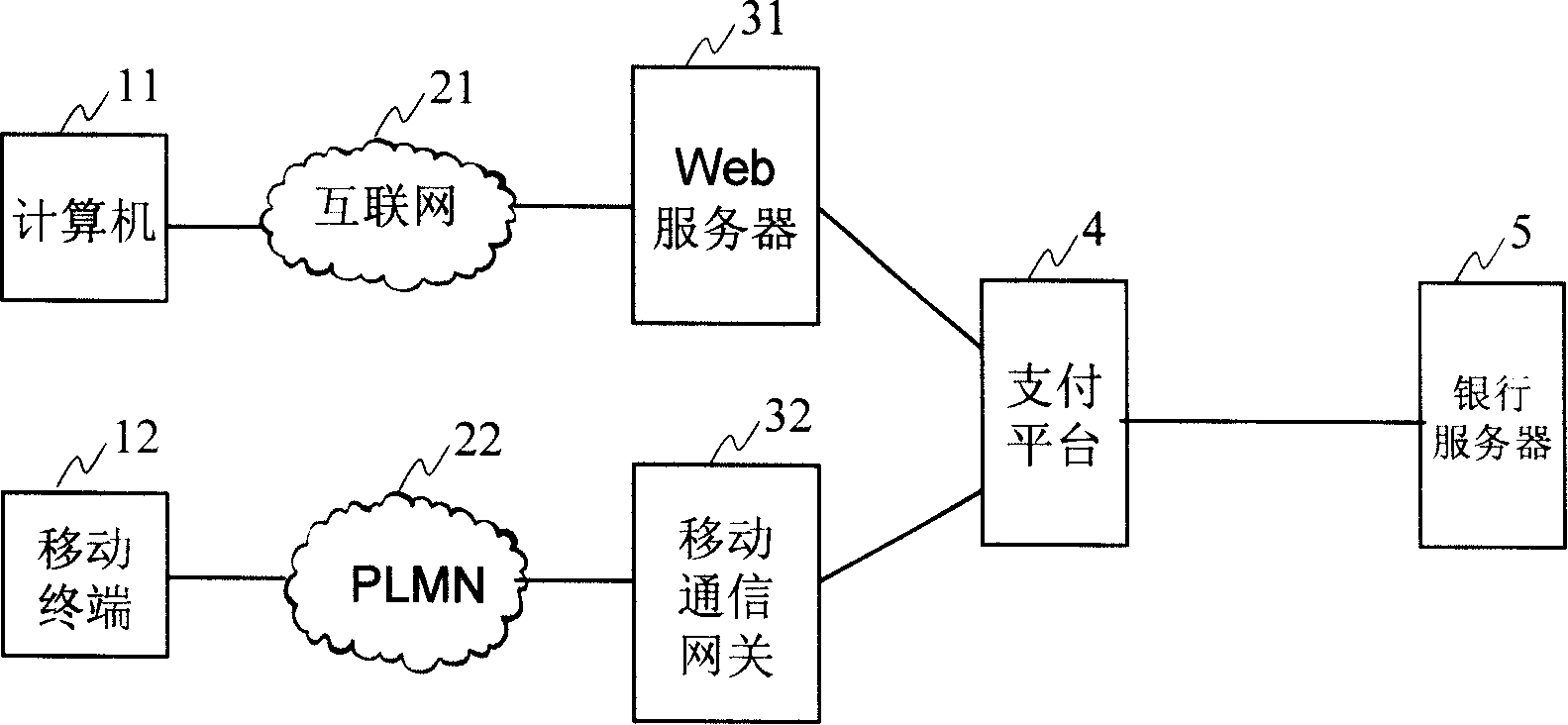

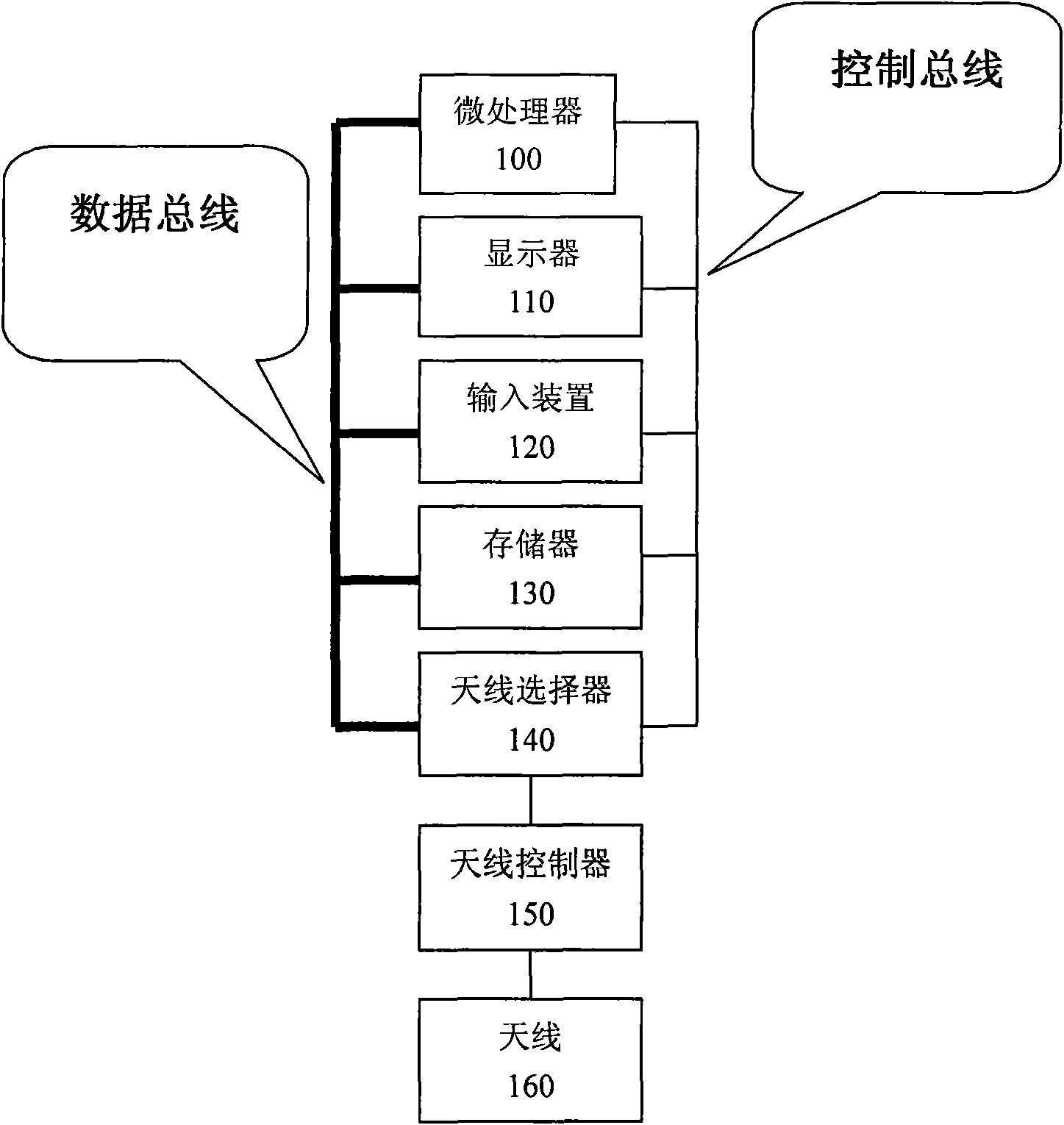

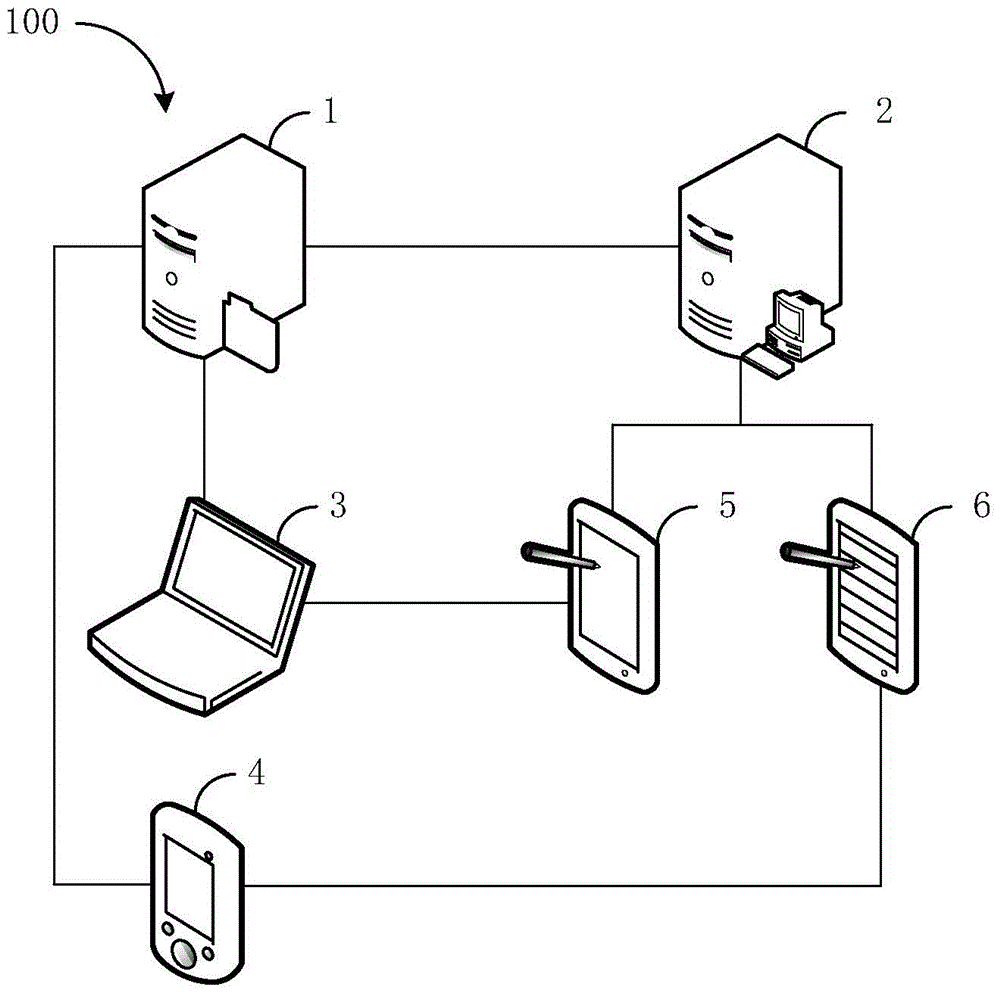

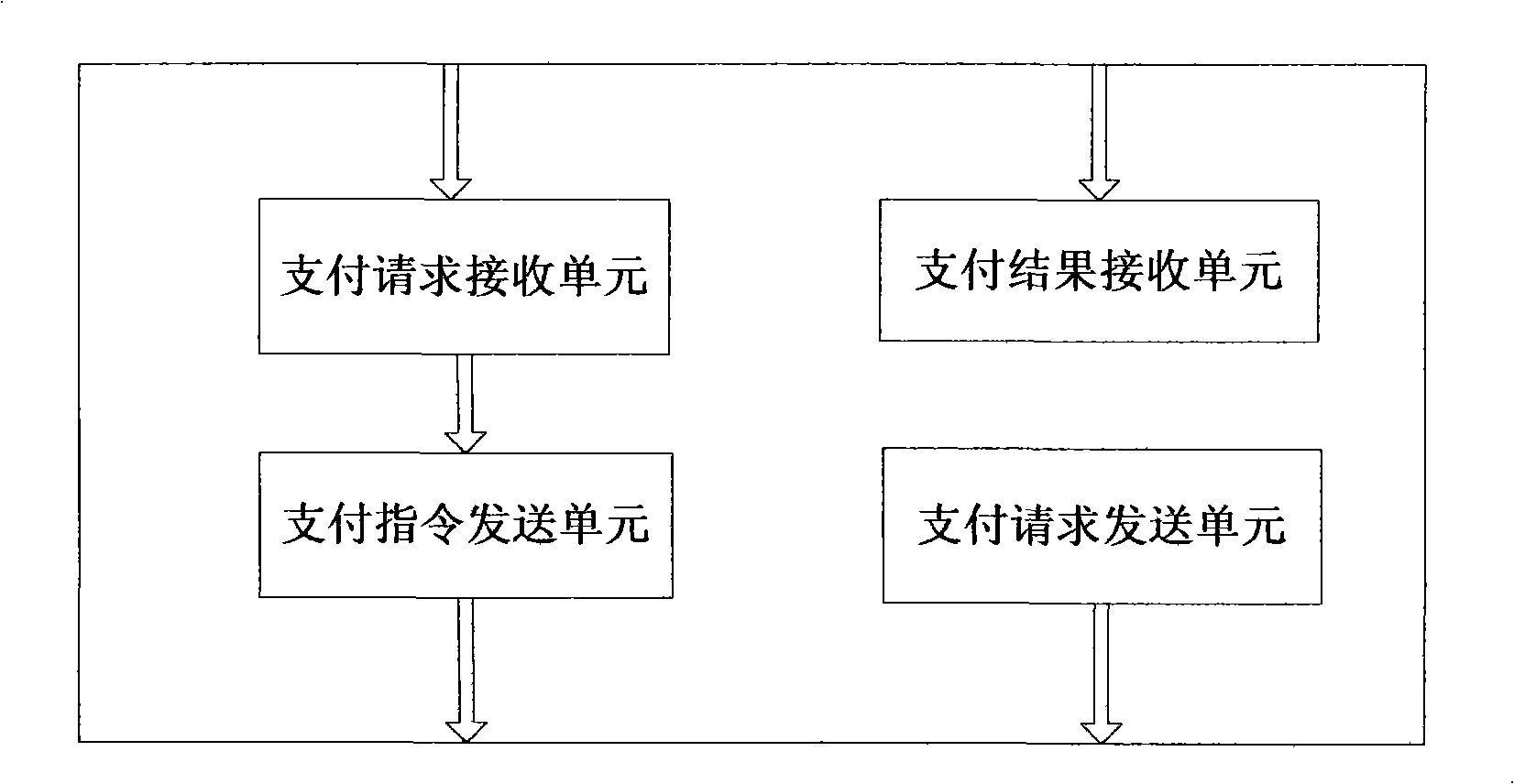

NFC mobile phones payment terminal, payment procedure and system

InactiveCN101290669AReduce riskTransmission data is accurate and reliablePayment architectureMobile paymentMobile phone

The invention discloses an NFC mobile phone payment terminal, a payment method and a system. The invention is designed to solve the problems that the prior mobile phone payment mode is troubled in operation and easy to go wrong; the system comprises a mobile phone terminal of a paying party, a mobile phone terminal of a paid party and a bank mobile payment server; the mobile phone terminal of the paid party is used for sending a payment request to the mobile phone terminal of the paying party by an NFC signal; and the mobile phone terminal of the paying party is used for receiving the payment request and sending a payment command to the bank mobile payment server according to the payment request; the bank mobile payment server receives the payment request, processes relevant financial information and sends an operation result to the mobile phone terminal of the paid party and the mobile phone terminal of the paying party. The NFC mobile phone payment terminal, the payment method and the system are suitable for consumption settlement between a consumer and a merchant and payment transfer among individuals.

Owner:BEIJING AIO TIME INFORMATION TECH

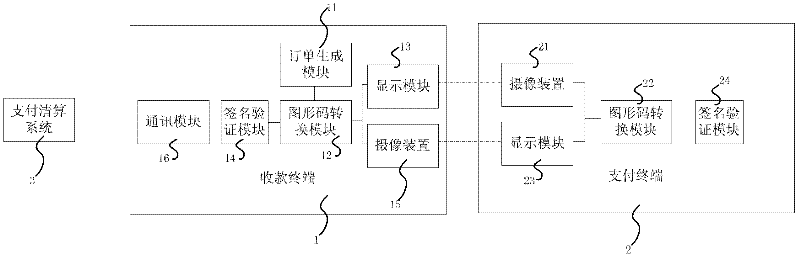

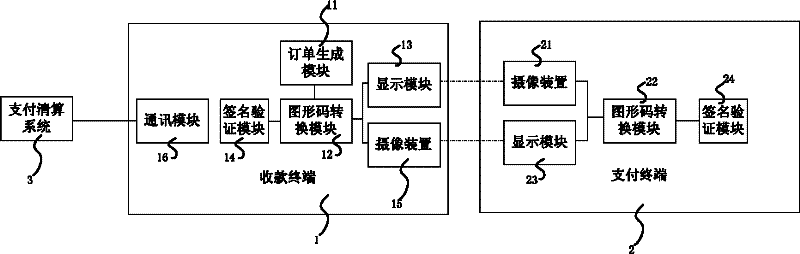

Short-distance payment system and payment procedure based on graphs

InactiveCN102449651AEnsure safetyNo communication charges incurredComplete banking machinesPrepayment using codeGraphicsShortest distance

The utility model relates to the mobile payment technology field, particularly to a short-distance payment system based on graphs. The payment system comprises a collecting terminal and a payment terminal, wherein the collecting terminal comprises: an order generating module for generating an order based on the goods selected by the client and the service information, a graphic code transforming module for transforming the order information into a graphic code image containing graphic code or identifying the order information from graphic code image, a display module for displaying the graphic code image generated by the graphic code transforming module, a camera device for capturing the graphic code image, and a communication module for communicating with a payment settlement system. The payment terminal comprises a camera device, a graphic code transforming module, and a display module. The invention also discloses a short-distance payment method based on graphs. The payment method requires no change to the hardware of a handset. Moreover, the handset and the collecting terminal carry out communication via mutual shooting, with no need for other communication, thereby being secure and reliable, generating no communicating fee, and ensuring the security of the transaction.

Owner:SHENZHEN NIANNIANKA NETWORK TECH +1

Payment program for use in point-of-sale transactions

In some embodiments, the present application relates to card-free programs provided by a merchant to a customer, whereby the customer has access to functions such as payment options and / or loyalty program benefits without needing to present a physical card at a point of sale. For example, a customer may make a card-free purchase of goods or services from a merchant, whereby the customer need not present a card such as a debit card, credit card, loyalty card, or other physical tender to make a purchase. Further, the customer need not provide biometric data or otherwise use an electronic device or identifier to make a purchase. Alternatively or additionally, the customer may access a loyalty program without needing to provide a physical card or data associated with a card.

Owner:SAFEWAY INC

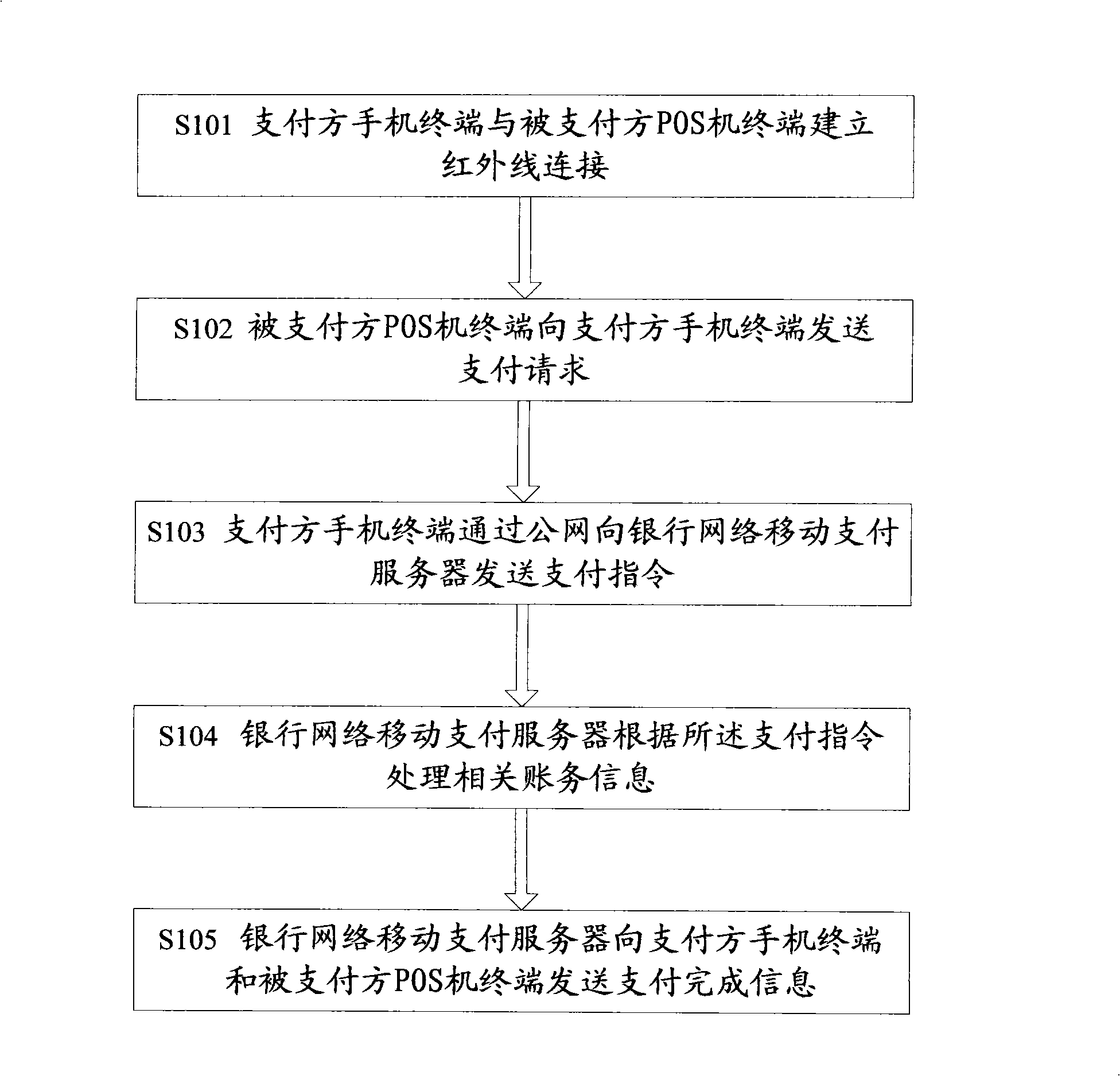

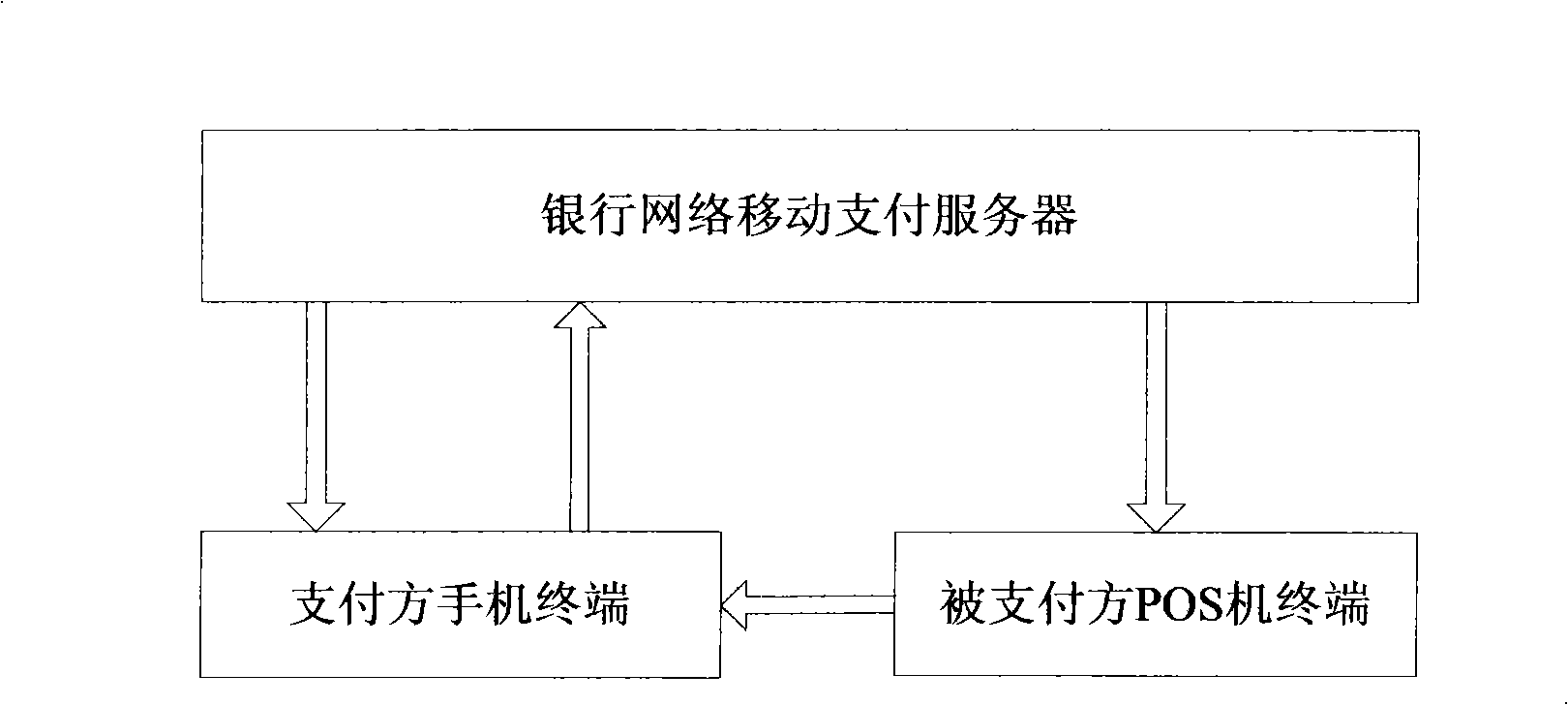

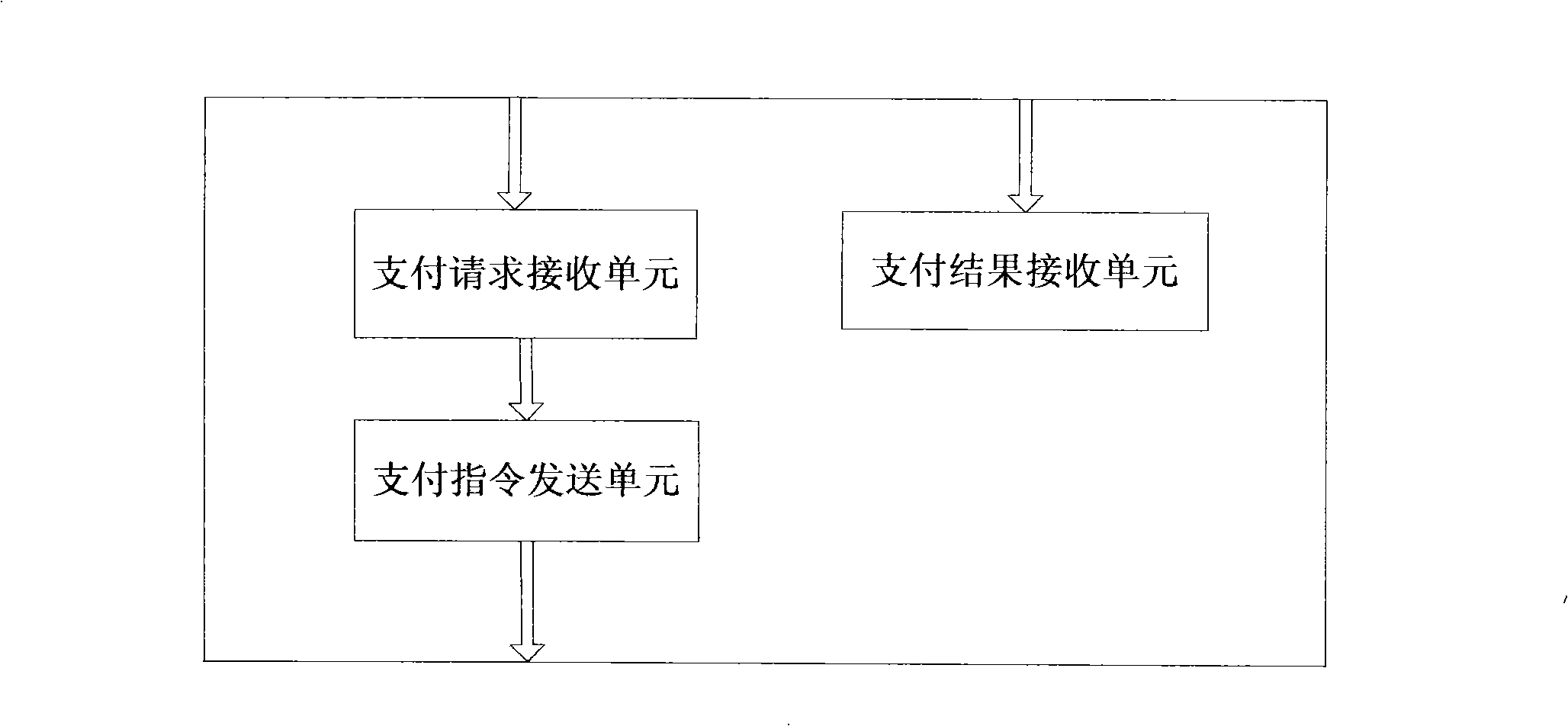

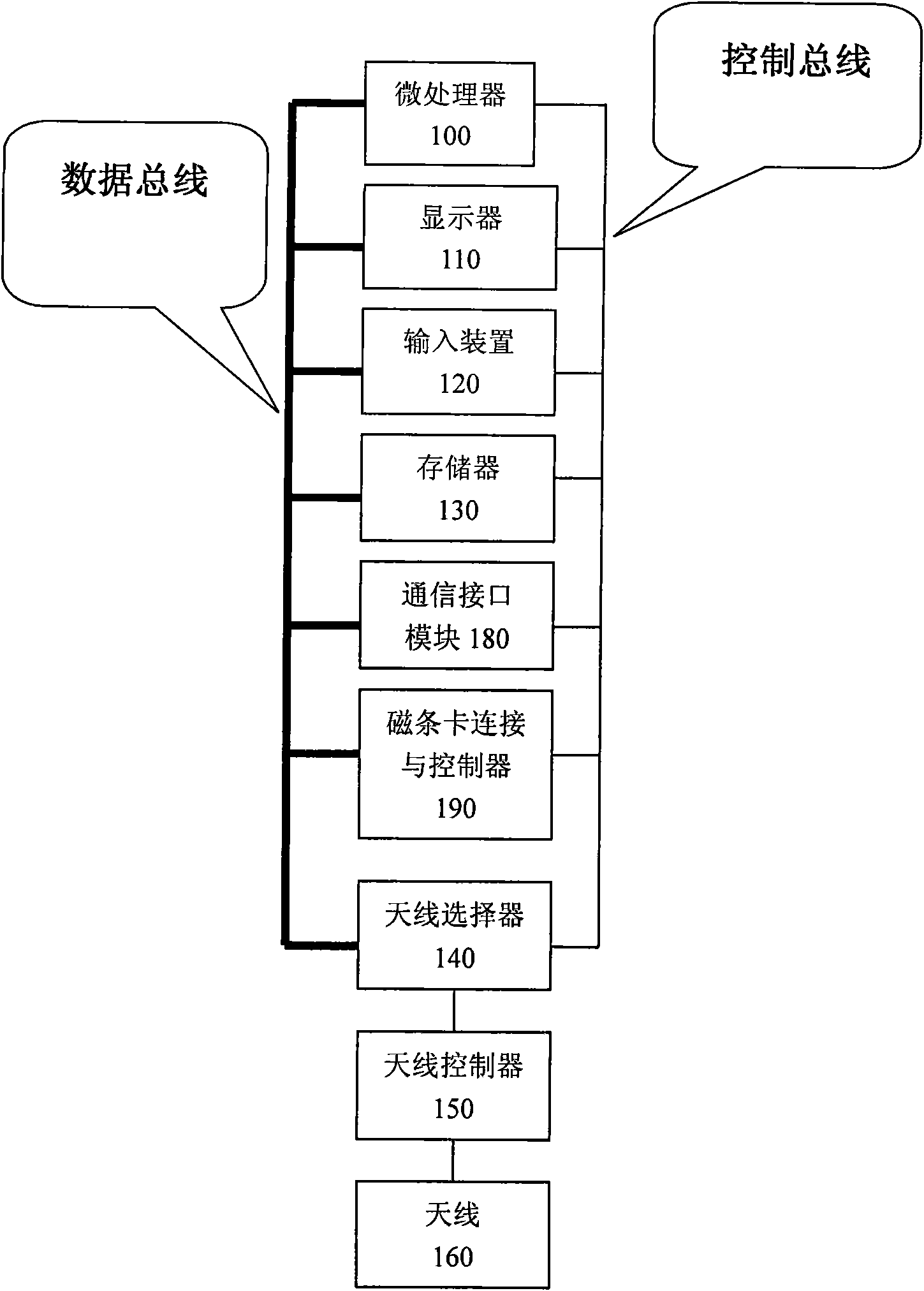

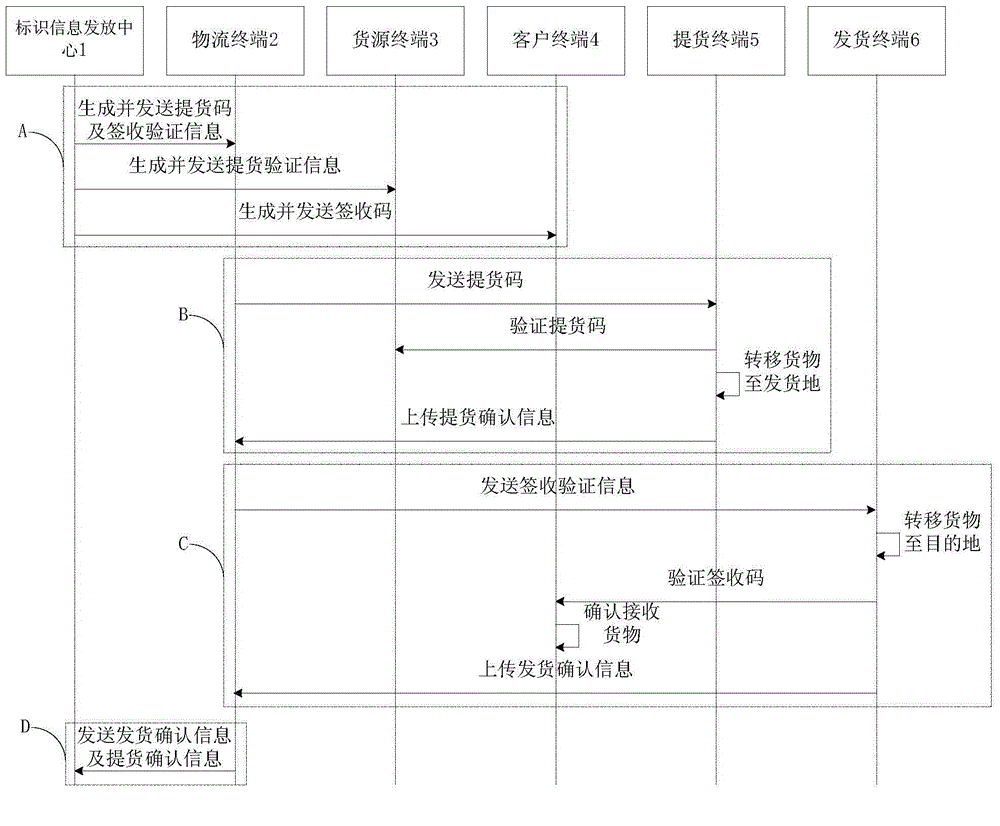

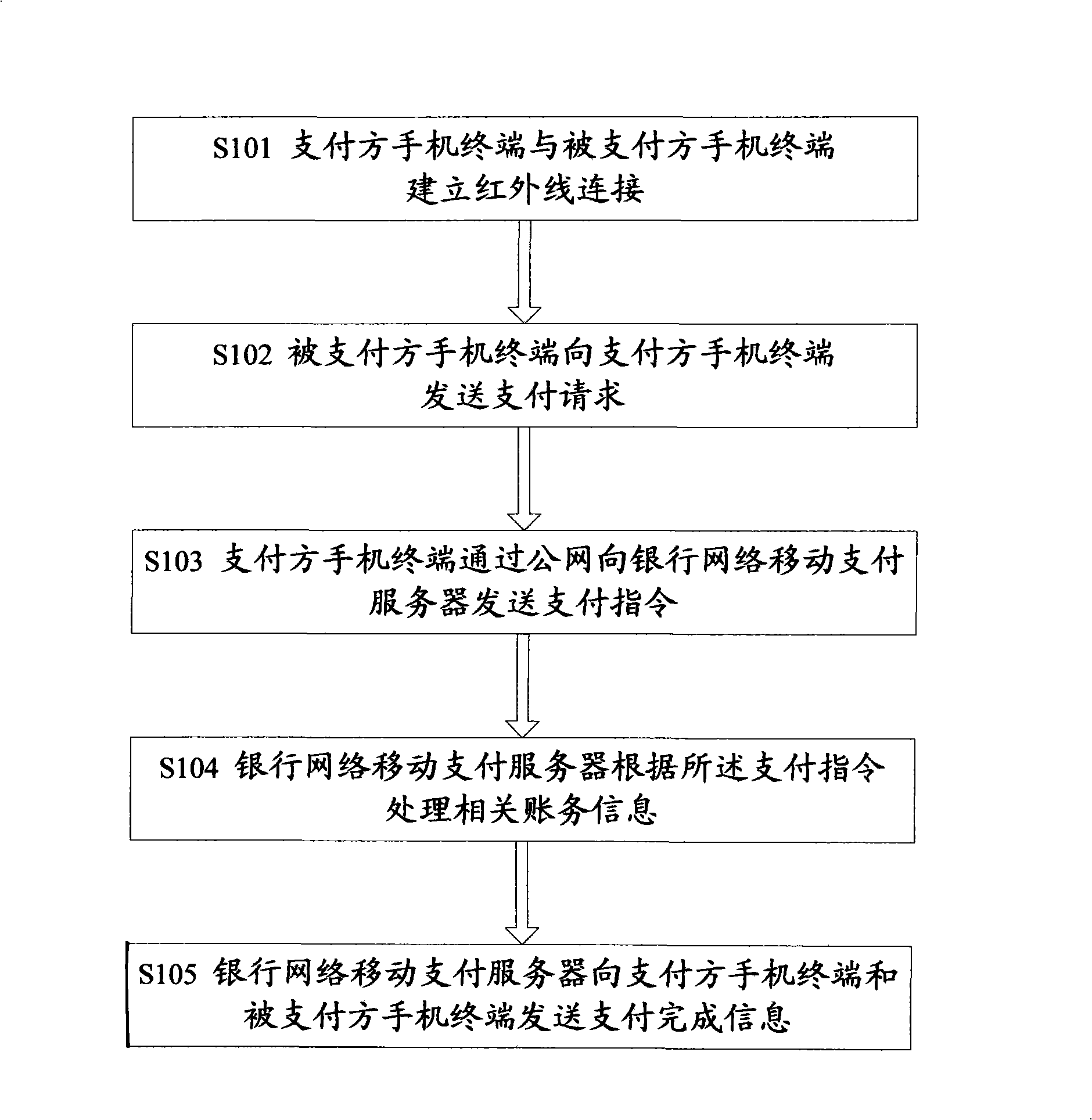

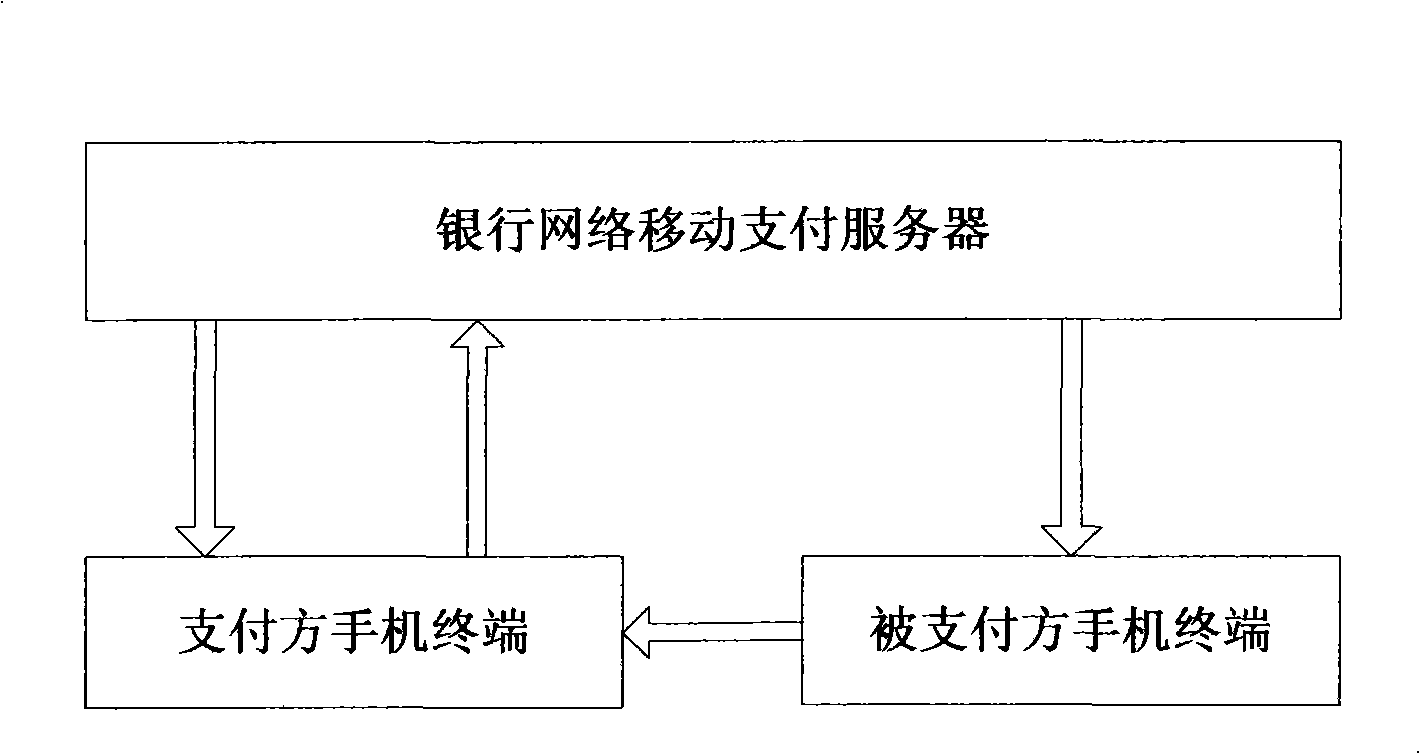

Infra-red ray mobile phones payment terminal, payment procedure and system

InactiveCN101339685AReduce riskInput less informationComplete banking machinesClose-range type systemsComputer terminalMobile payment

The invention discloses an infrared mobile phone payment terminal, a payment method and a payment system which are designed for solving the problems that the payment mode of the existing mobile phone is complicated to be operated and is easy to get wrong. The system comprises a payer mobile phone terminal, a payee POS machine terminal and a bank network mobile payment server; the payee POS machine terminal is used for sending a payment request to the payer mobile phone terminal by an infrared signal; the payer mobile phone terminal is used for receiving the payment request and sending a payment instruction to the bank network mobile payment server based on the payment request; the bank network mobile payment server is used for receiving the payment request, processing the related financial information and sending the operation result to the payee POS machine terminal and the payer mobile phone terminal. The infrared mobile phone payment terminal, the payment method and the payment system of the invention are suitable for the consumption settlement between consumers and shops.

Owner:BEIJING AIO TIME INFORMATION TECH

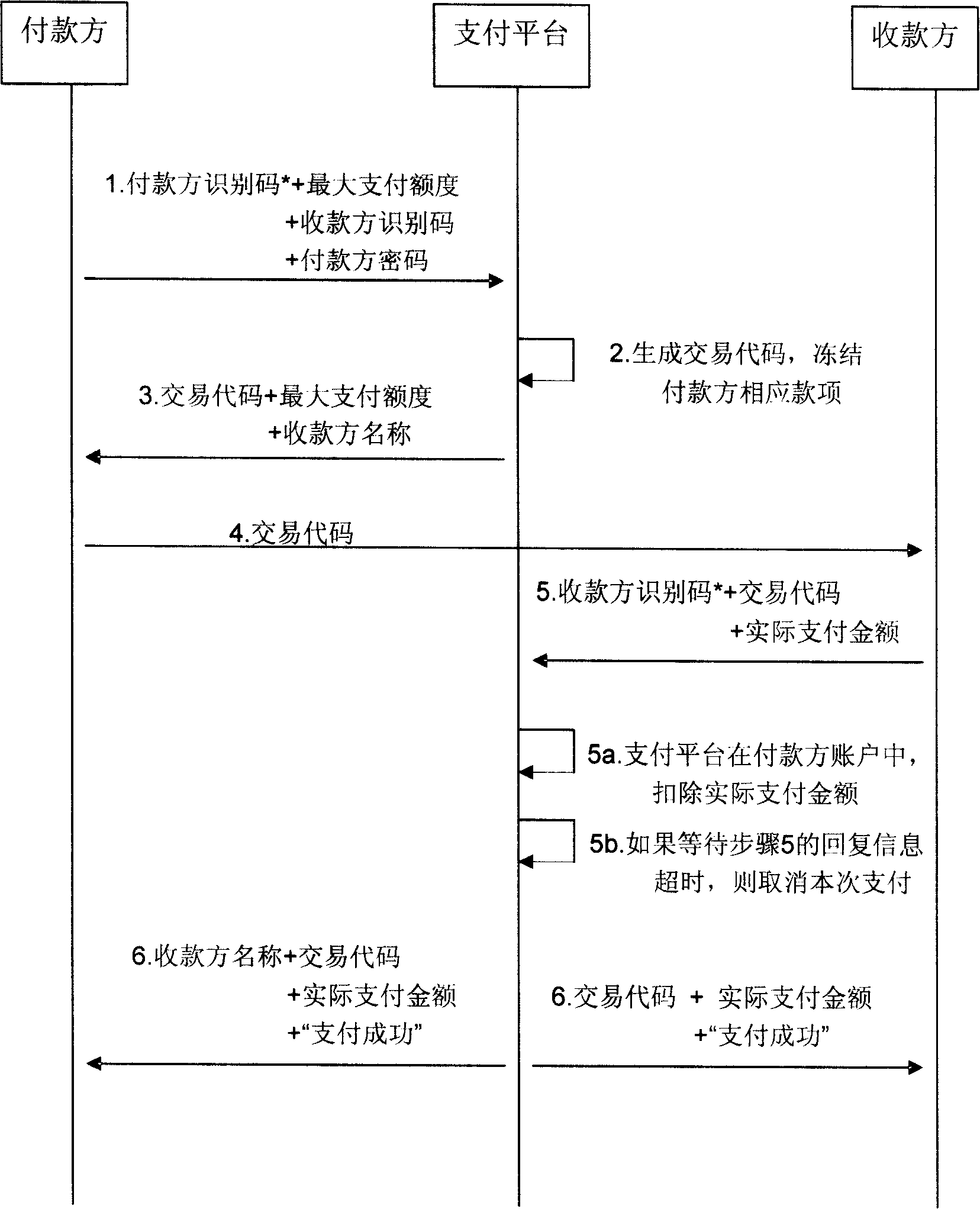

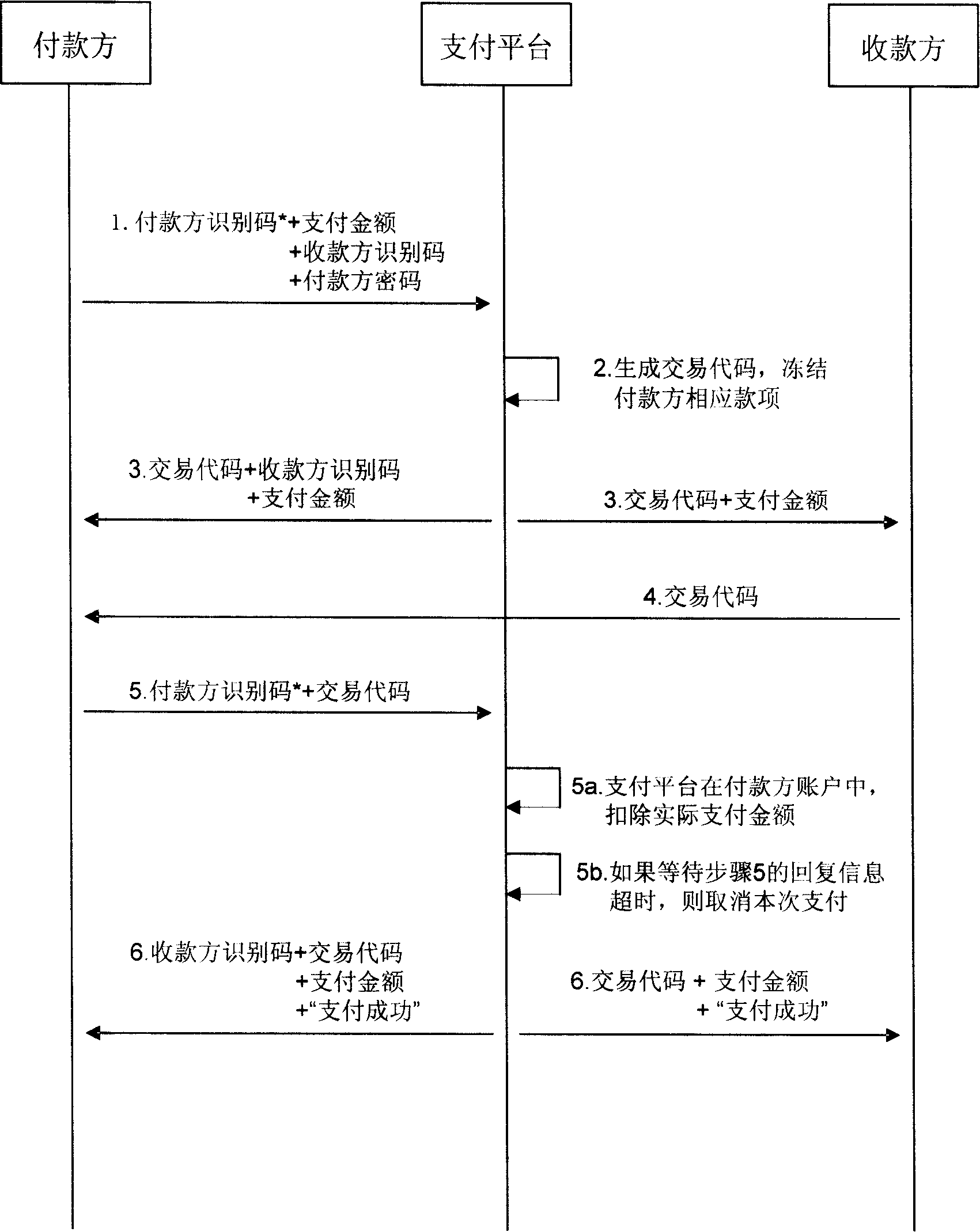

Electronic payment procedure based on transaction code

InactiveCN101165716ASave payment timeImprove securityPayment architecturePayment orderComputer science

The method comprises: when the payment side makes a payment to the collection side, it sends the payment side ID code, maximal payment, and collection side ID code to the payment platform to generate a transaction code; the payment platform sends the transaction code and maximal payment to the payment side; the payment side sends the transaction code to the collection side; the collection side sends the collection side ID code, transaction code and actual payment to the payment platform; the payment platform sends a message of successful payment to both payment and collection sides.

Owner:祁勇

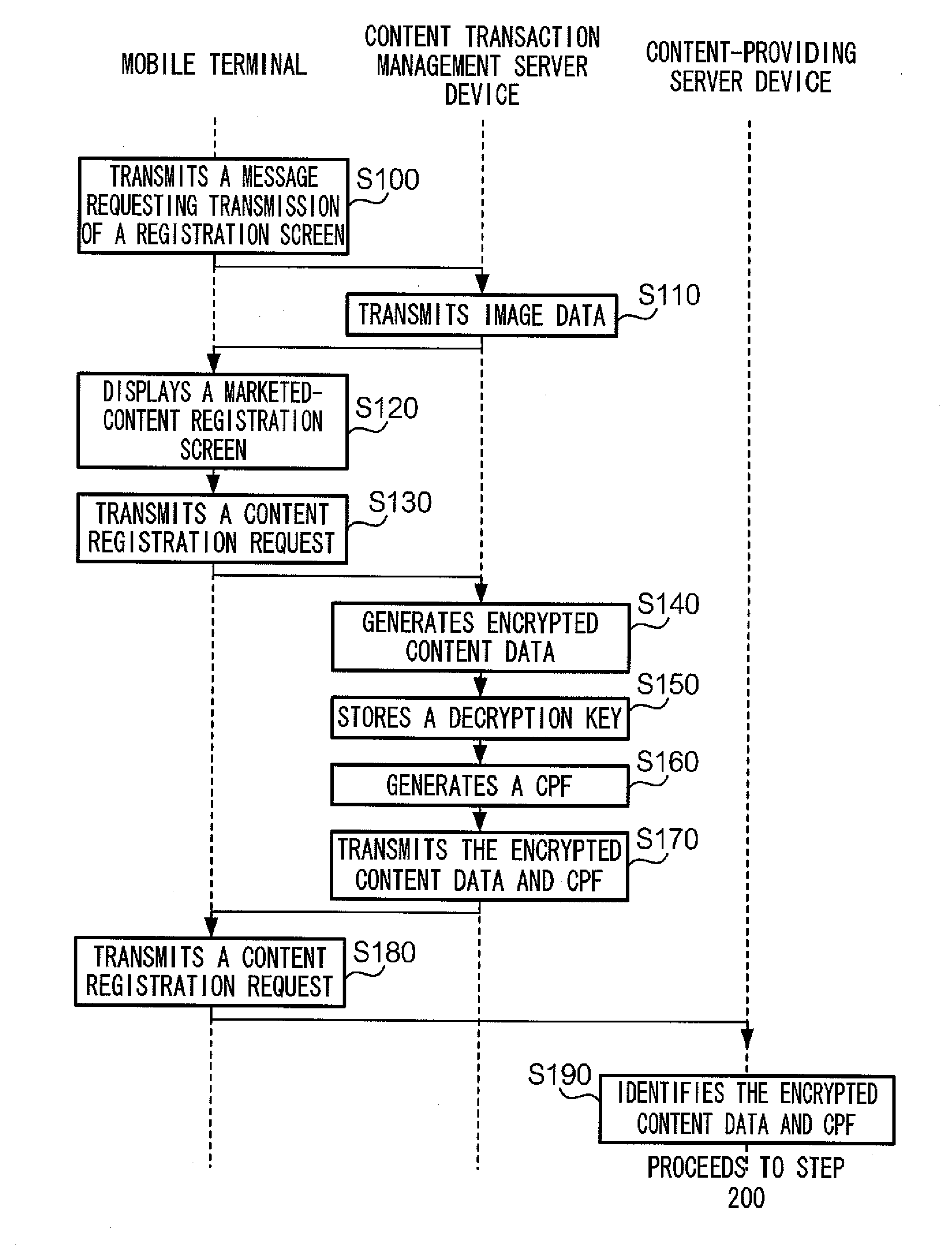

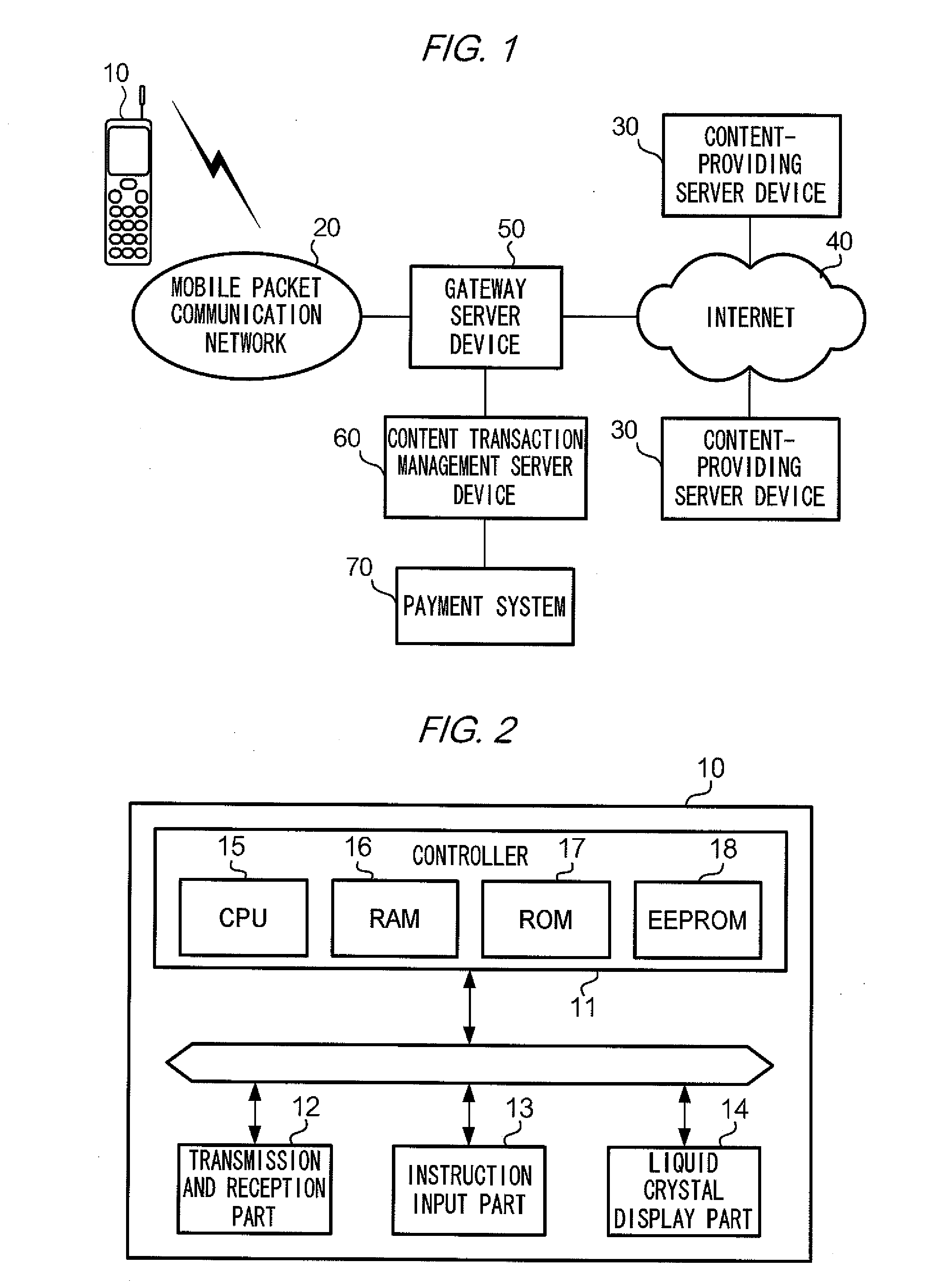

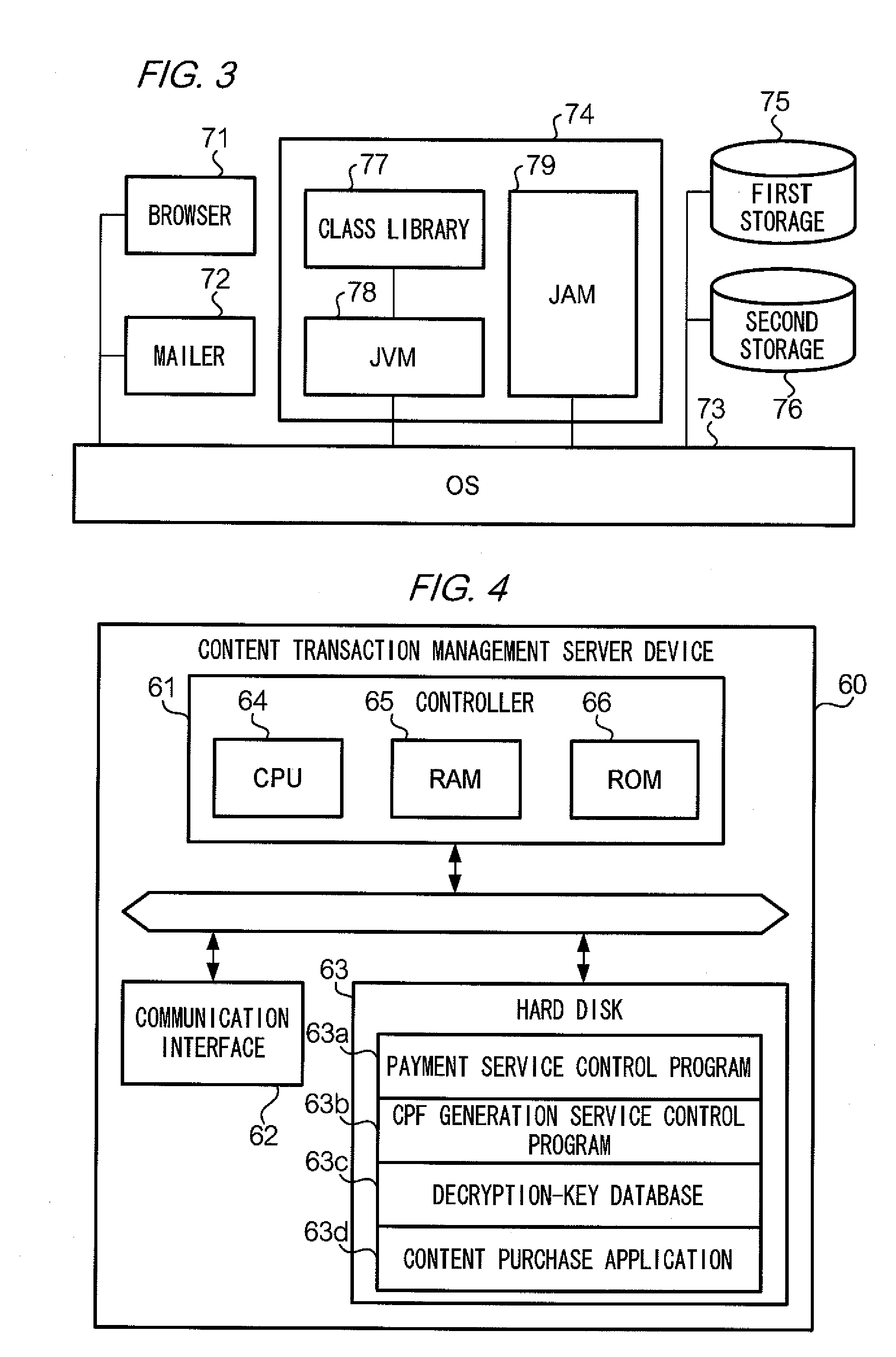

Content transaction management server device, content-providing server device, and terminal device and control program

InactiveUS20110004555A1Efficient executionKey distribution for secure communicationDigital data protectionCommunication unitTransaction management

A content transaction management server device includes: a memory storing decryption keys used in decryption of encrypted content data; a communication unit for information; a payment-request reception unit receiving, through the communication unit, a first storage address indicating a storage area where the decryption keys of encrypted content data in the memory are stored and user identifiers identifying users who are purchasers of the encrypted content data; a payment-procedure processing unit implementing payment-procedure processes related to purchase transactions of encrypted content data by a user identified by user identifiers in the payment request; and a decryption-key transmission unit that, after payment-procedure processing based on the payment-procedure processing unit is completed, reads out, from the memory, decryption keys stored in the storage area indicated by the first storage address included in the payment request and transmits, through the communication unit, the decryption keys to the transmission source of the payment request.

Owner:NTT DOCOMO INC

Electronic payment device for personal use

The invention relates to an electronic payment device for personal use, which integrates a variety of entity IC cards, an access card, an attendance card and an RFID card into the electronic payment device in the electronic mode, that is the electronic payment device adopts the interactive electronic payment device to replace the solid entity cards, thereby leading a user to be capable of managingand controlling the electronic payment device through an electronic payment procedure and checking the balance and the transaction records of a variety of accounts, if lost, the electronic payment device does not cause loss or safety risk to the user through the protection of fingerprint verification.

Owner:山东森泽信息科技有限公司

Method for performing transactional communication using a universal transaction account identifier assigned to a customer

Methods, systems, computer data signals, recordable media and methods of doing business for wireless or wired network communication between network resources each having a unique telephone number associated therewith, including, among other feature, forming a primary number file (PNF) comprising a uniform telephone address (UTA) which has a telephone number associated with a network resource.User-friendly and seamless payment procedure is provided wherein payer or payee only need to know accordingly the payee or payer UTA number to allow transaction and seamless payment routing between payer and payee bank accounts. Unified approach is allowed wherein financial institution also are networking Targets having UTA numbers assigned for them and the financial institution can receive Fund Transfer Agreement or Deal Agreement from networking Targets, authenticate payer using particular Target UTA and apply the payment from this particular UTA bank account.Internet Settlement Architecture provides unique implementation of a clearing routes ranging by using cost command for EEP; and the ranging in turn allows the routing management by using cost and time user preferences, thus allowing operational cost management implementation for financial institutions and their respective customers using cost tracing command. On-line, multi-tier and multi-route clearing infrastructure and payment services provide seamless and transparent payment cost and payment routing management, enabling End-to-End payment Straight Through Processing (STP). Network specific identifiers (such as UTA, ZUTA and others) and the network specific software user interfaces (phone user interface and only numeric keyboards) may be used to navigate and manage the Internet Settlement Infrastructure enabling seamless payment addressing and clearing. Users are enabled to address payments without a need to know payee's banking details and payment routing information providing End-to-End account details resolution and Straight Through Processing for payment clearing services. Payment processing is diverted into online communication. Extensive use of the PKI trusted sources enables trusted financial account mappings allowing secure payment and clearing environment. The use of Attribute Certificates containing only payer network address mapped to its DCF network address allows filling in the DNS system database with the trusted mapping information avoiding the need to disclose the real banking details of the payee to a public. The use of existing DNS technology for resolution of trusted mapping information allows seamless gathering of banking routing information enabling on-line straight through processing.

Owner:SEREBRENNIKOV OLEG

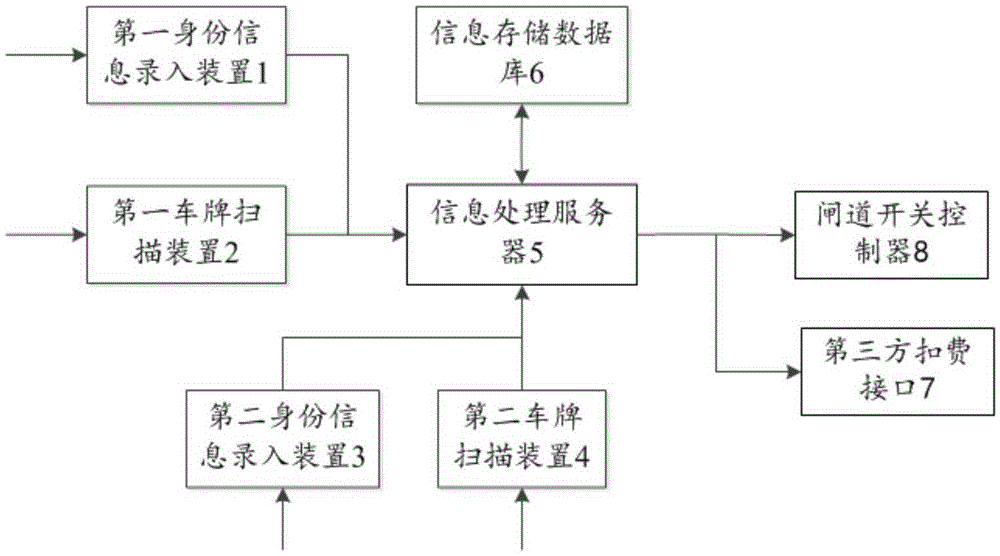

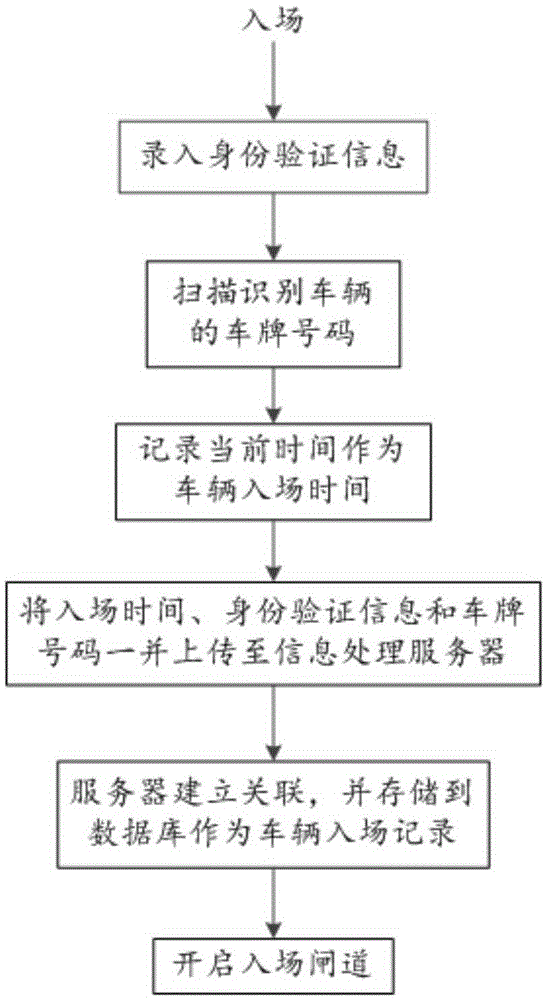

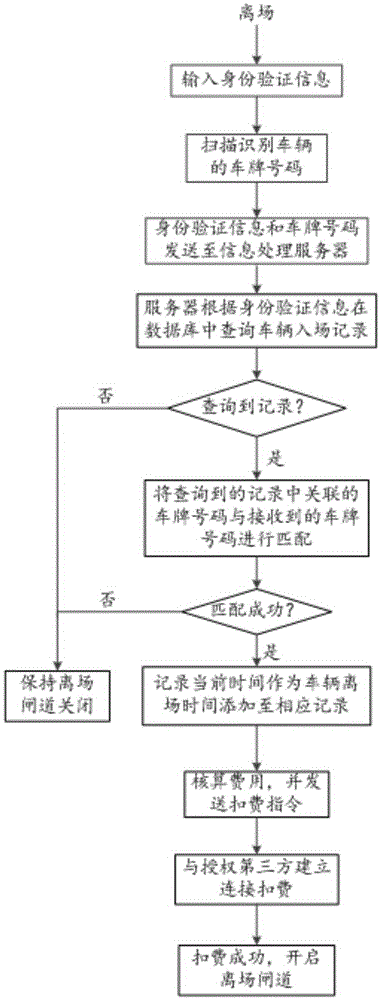

Parking lot management system and method thereof

InactiveCN105427422AImprove anti-theftImprove securityTicket-issuing apparatusIndividual entry/exit registersInformation processingPayment procedure

The invention provides a parking lot management system and a method thereof. The system comprises a first identity information input device, a first license plate scanning device, a second identity information input device, a second license plate scanning device, an information processing server, an information storage database, a third party fee deduction interface and a barrier gate switch controller, wherein the information processing server is in communication connection with the first identity information input device, the first license plate scanning device, the second identity information input device, the second license plate scanning device, the information storage database, the third party fee deduction interface and the barrier gate switch controller through a wireless or wired network. By means of the parking lot management system and the method thereof, identity authentication is conducted on a driver at an entrance / exit so that the vehicle stealing situation can be effectively prevented, meanwhile, the automatic fee deduction function on the premise of vehicle owner authorization is provided so that quick and convenient fee payment can be achieved, vehicle egression and ingression are made to be more smooth, and vehicle jam at the entrance / exit caused by the fee payment procedure is reduced.

Owner:LEADER TECH BEIJING DIGITAL TECH

Payment program for use in point-of-sale transactions

In some embodiments, the present application relates to card-free programs provided by a merchant to a customer, whereby the customer has access to functions such as payment options and / or loyalty program benefits without needing to present a physical card at a point of sale. For example, a customer may make a card-free purchase of goods or services from a merchant, whereby the customer need not present a card such as a debit card, credit card, loyalty card, or other physical tender to make a purchase. Further, the customer need not provide biometric data or otherwise use an electronic device or identifier to make a purchase. Alternatively or additionally, the customer may access a loyalty program without needing to provide a physical card or data associated with a card.

Owner:SAFEWAY INC

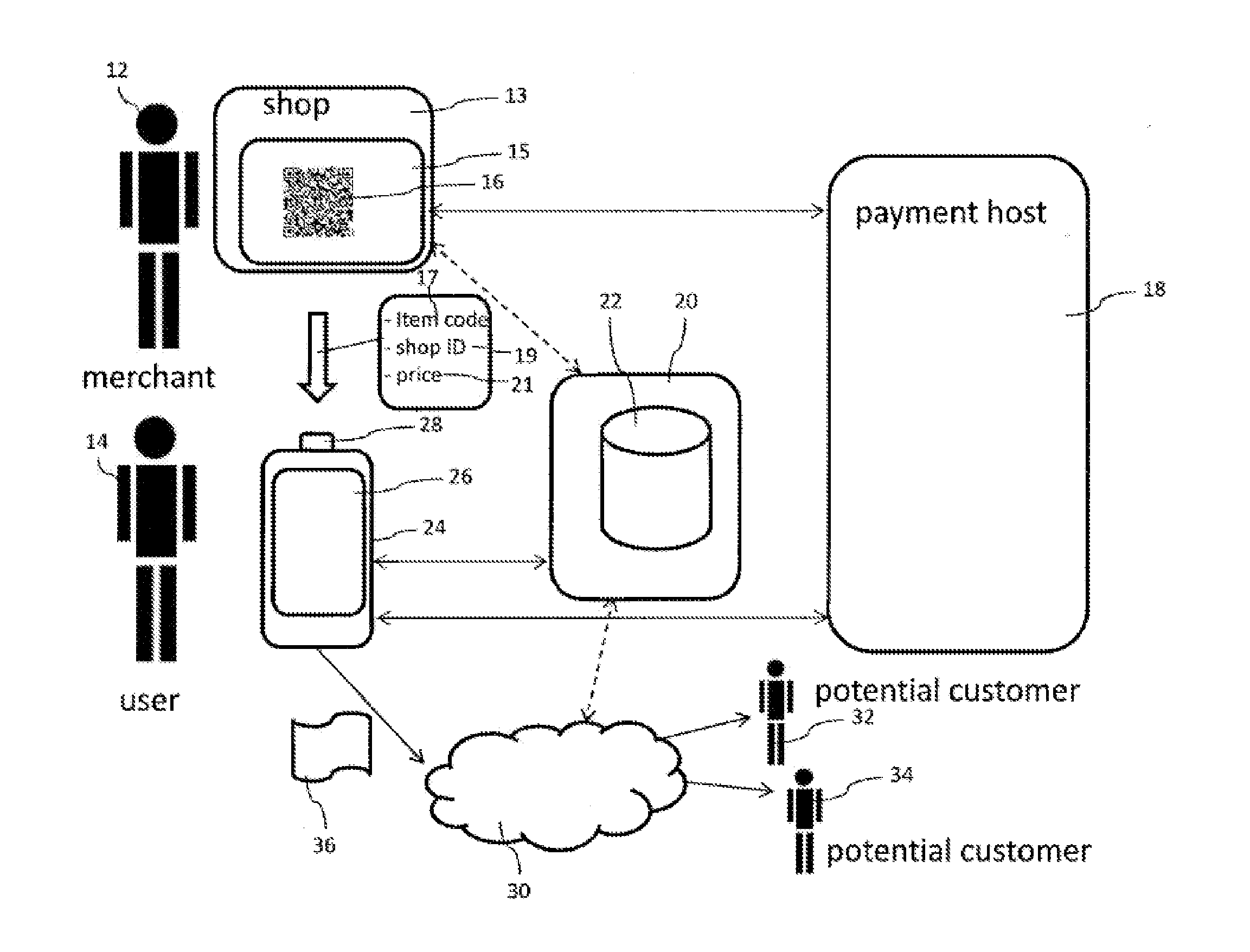

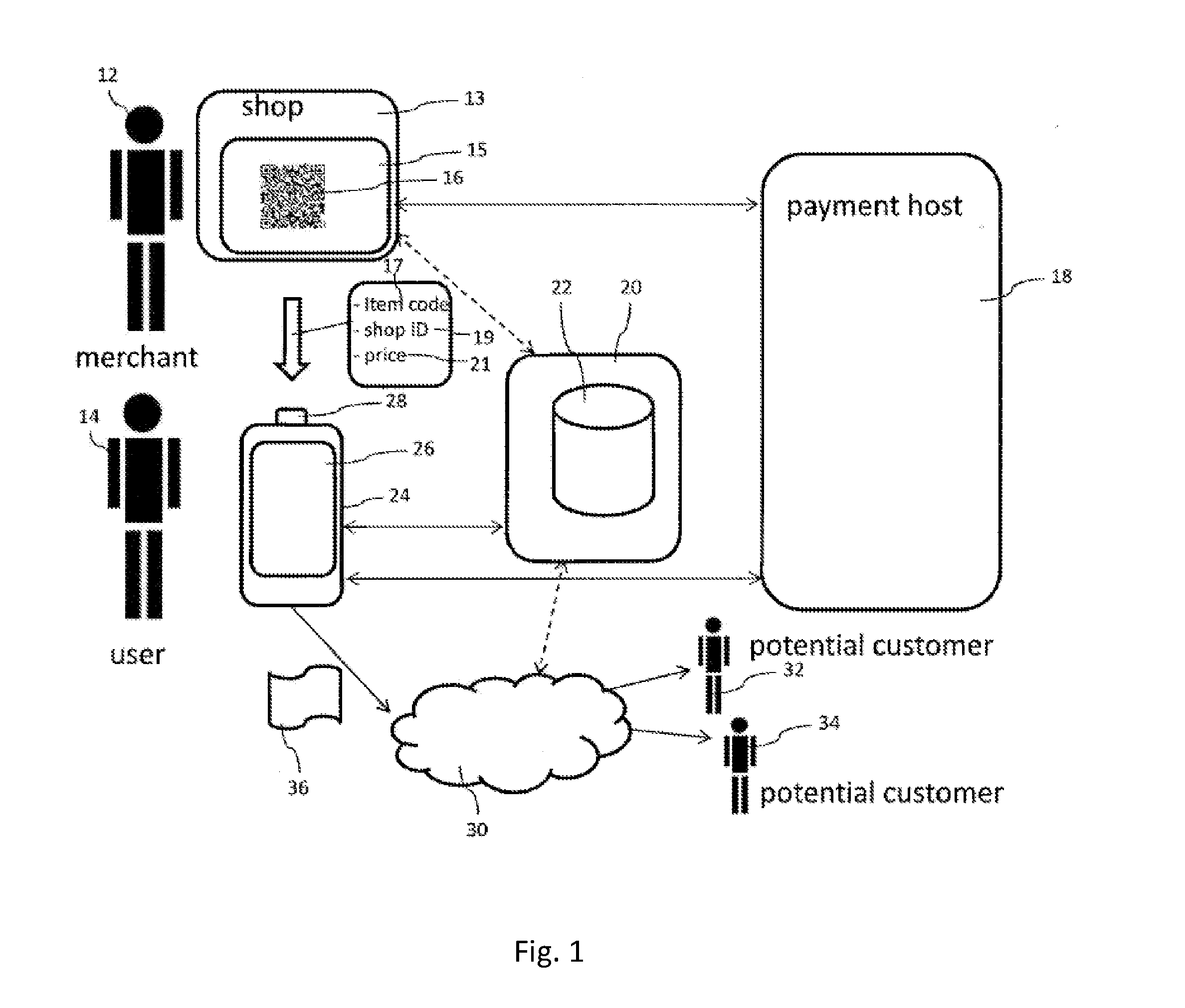

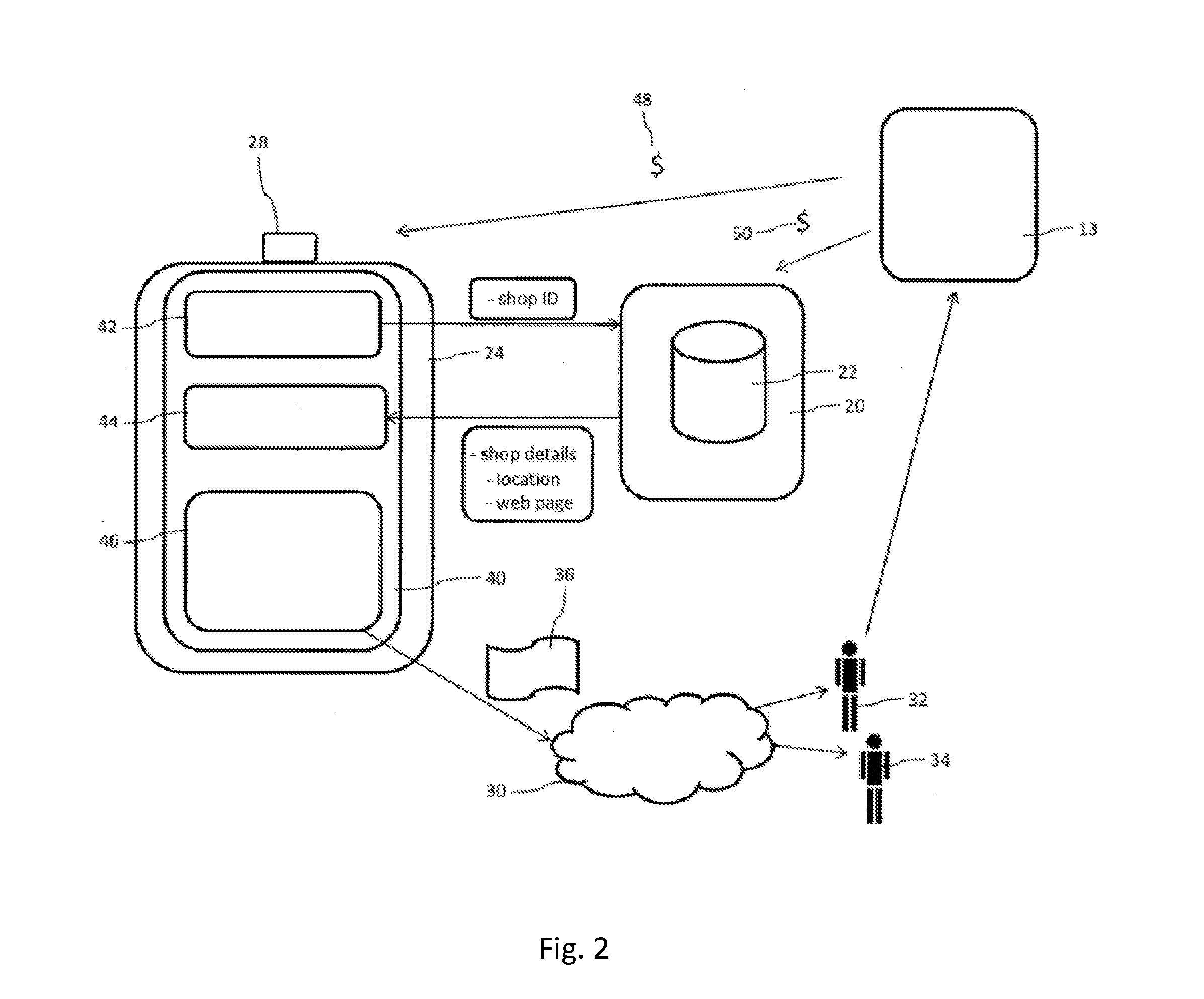

Mobile advertising system

InactiveUS20140108111A1Increasing user 'sEfficient separationPayment architectureMarketingOnline advertisingMobile device

A mobile advertising system, a respective method and to a computer program product, wherein the mobile advertising system includes one or more mobile devices configured to capture a merchant's encoded vending detail, and being configured to communicate with a remote payment host. Upon completion of a payment procedure, the mobile device is operable to generate a recommendation on the basis of the captured vending details and to transfer the recommendation to at least one potential customer via a network.

Owner:PAIJ

Relay server, relaying method and payment system

InactiveUS20070162386A1Limited display capabilityImprove securityComplete banking machinesFinanceProcedure requestedPayment order

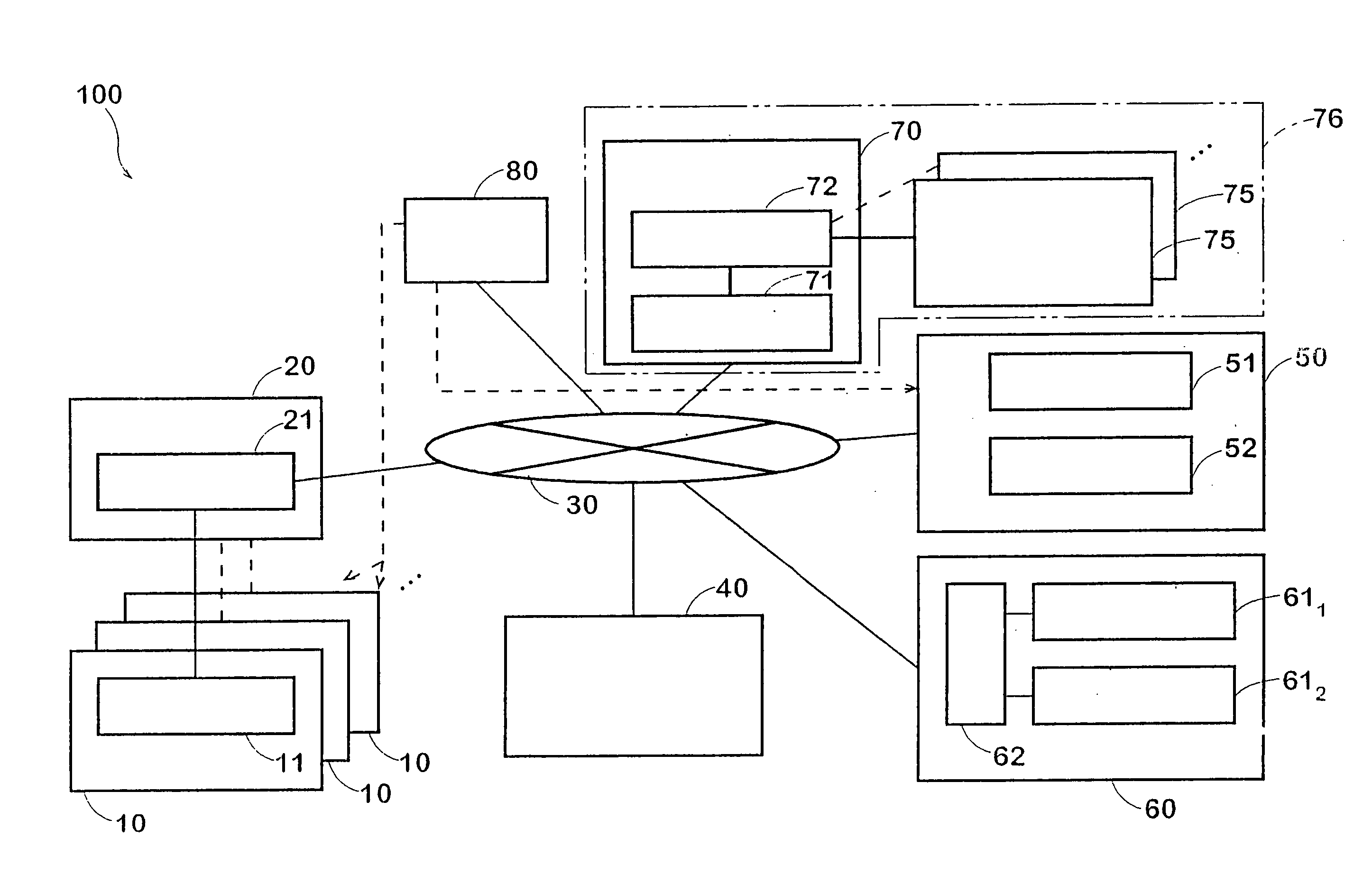

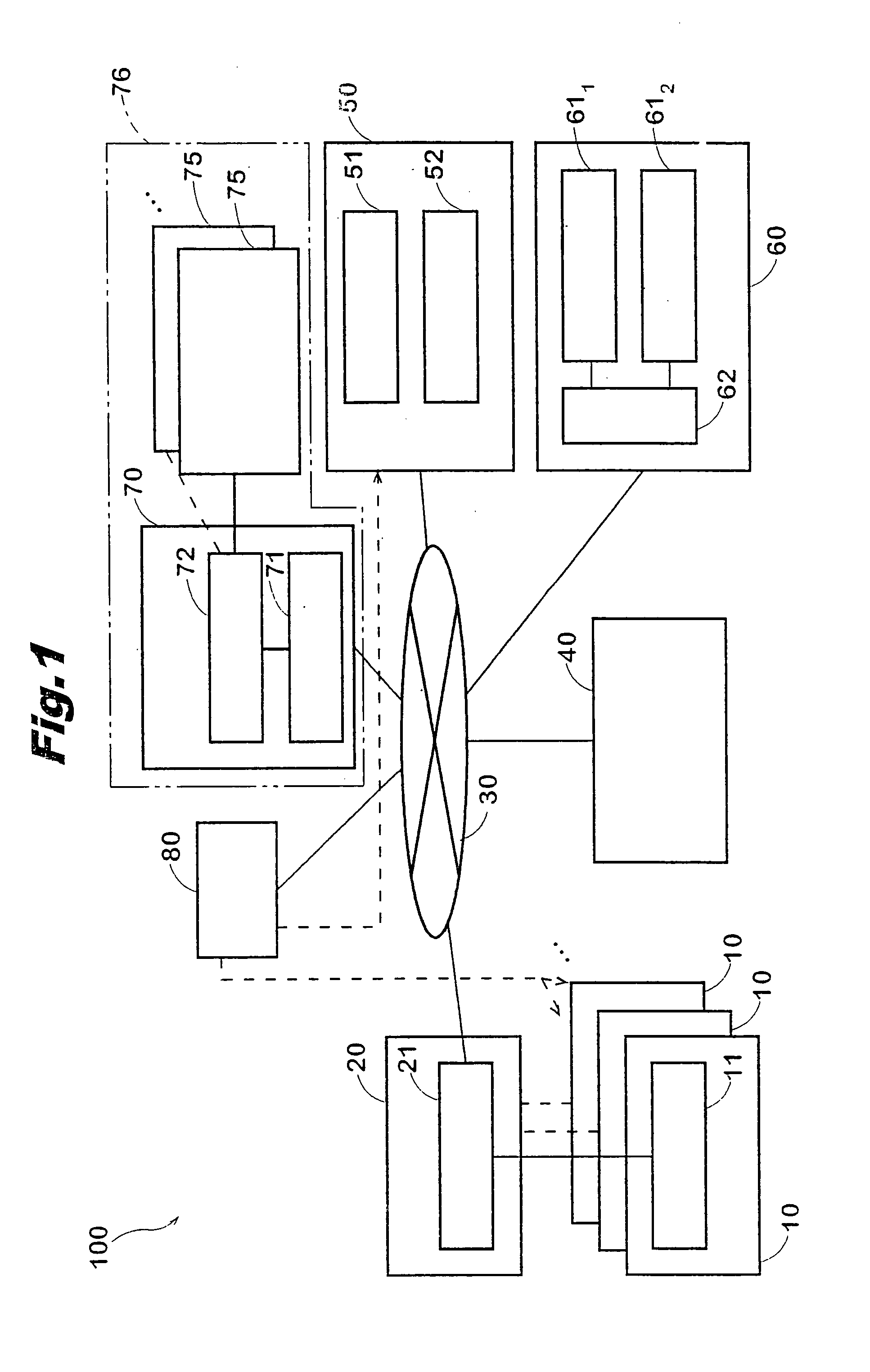

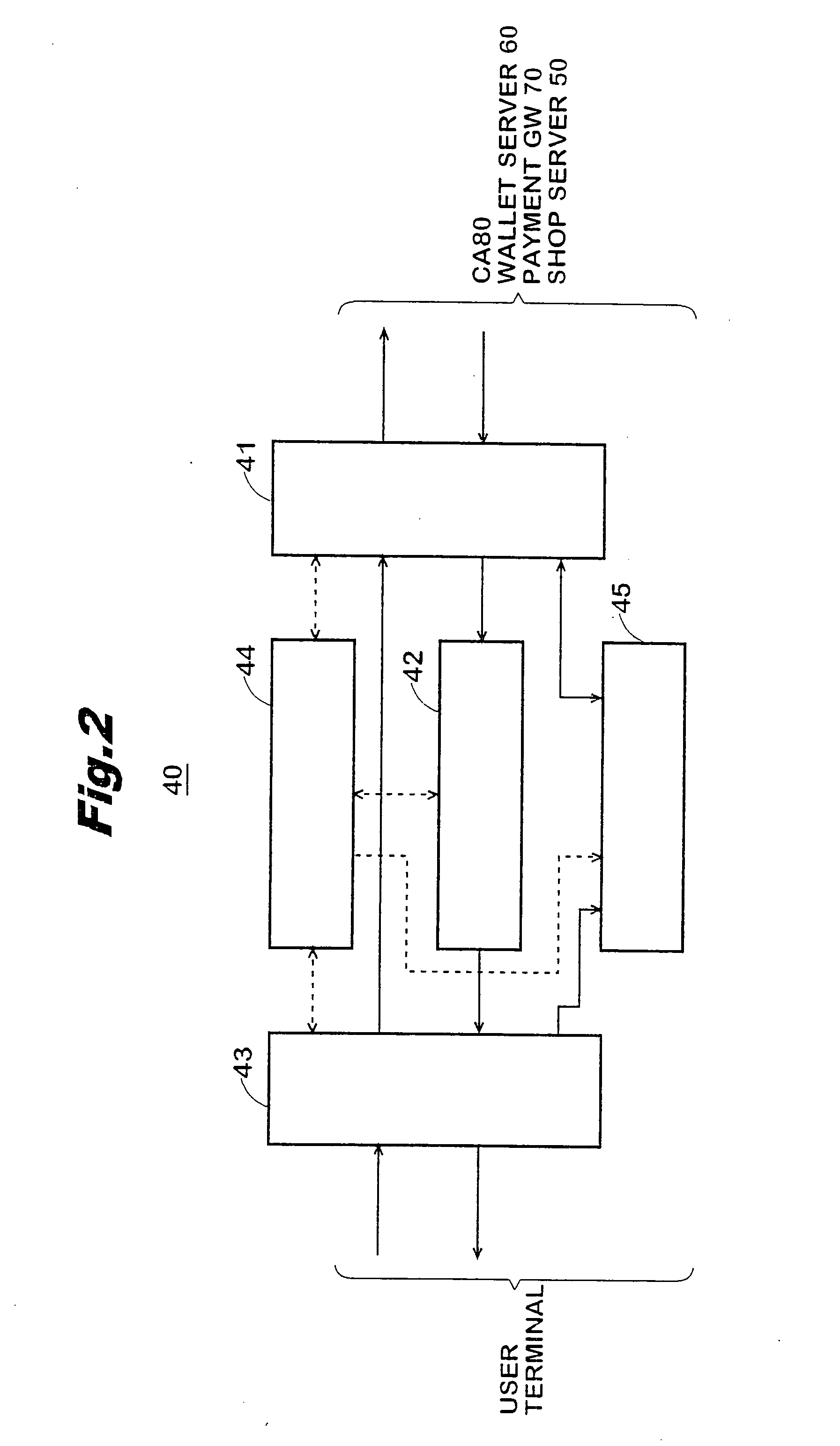

A relay server to be installed in a payment system which is suitably used in a specially designed terminal having limited communication functions such as a portable telephone. The relay server is provided in the payment system including a user terminal to take payment procedures through a network, a shop server to produce payment information containing amounts to be paid by a user, a payment server to perform payment processing through the network and a wallet server to maintain authentication information of the user and to request the payment server to take payment procedures. The relay server has a redirecting section used to transfer, when receiving procedure request information from the terminal, the information to the shop server and, when receiving the payment information from the shop server having acquired the request information, to transfer the payment information to the wallet server.

Owner:OKI ELECTRIC IND CO LTD

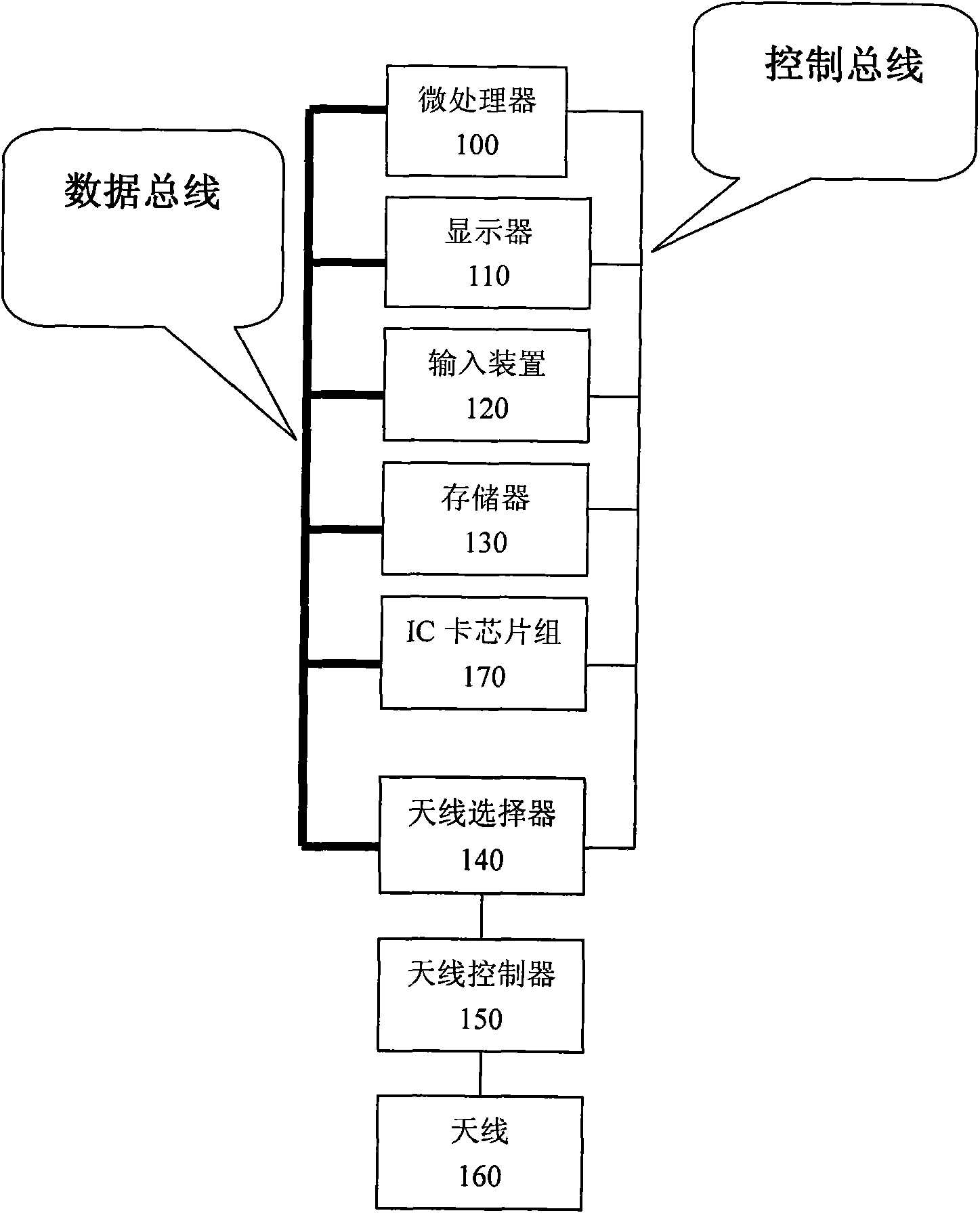

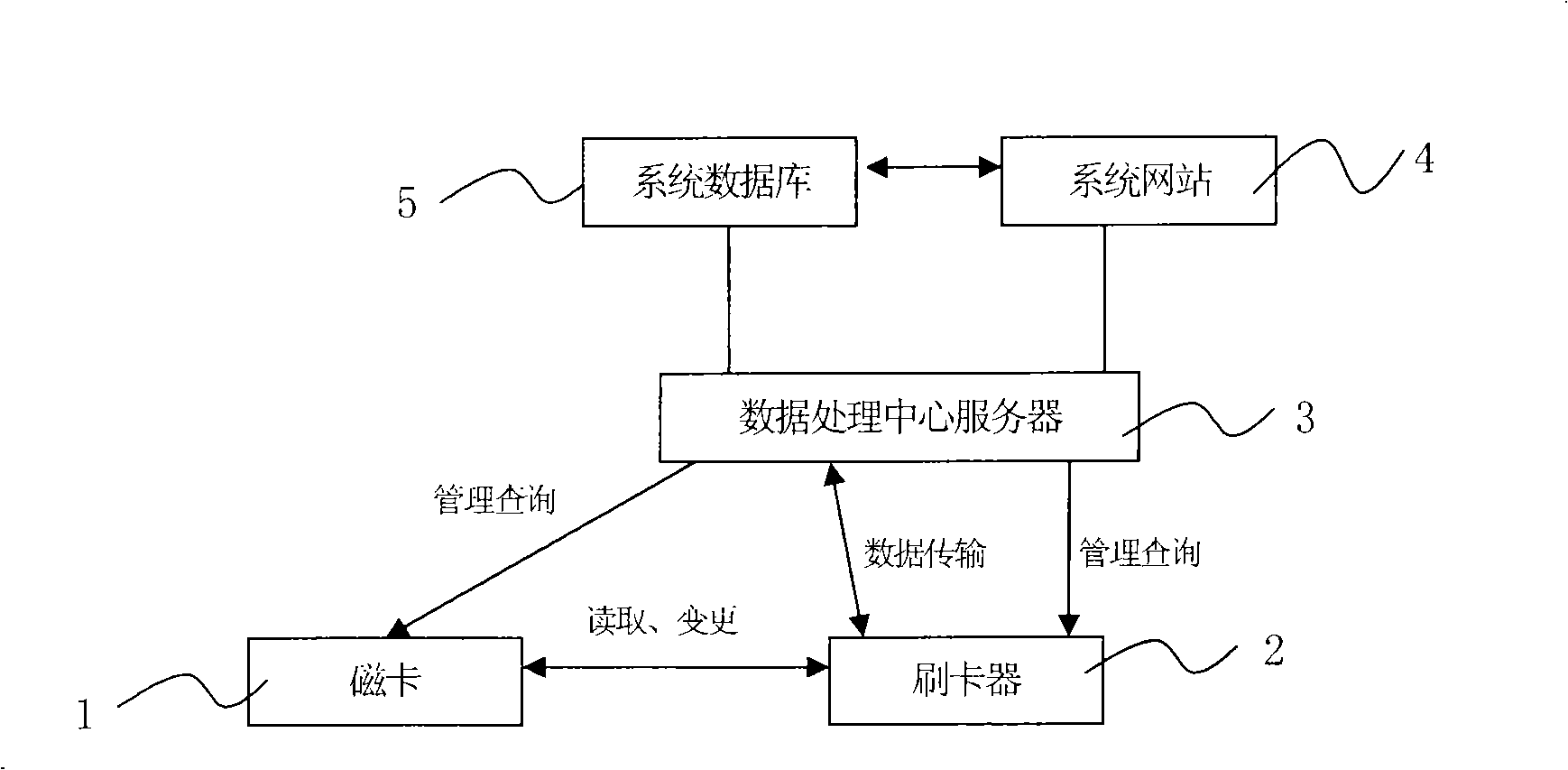

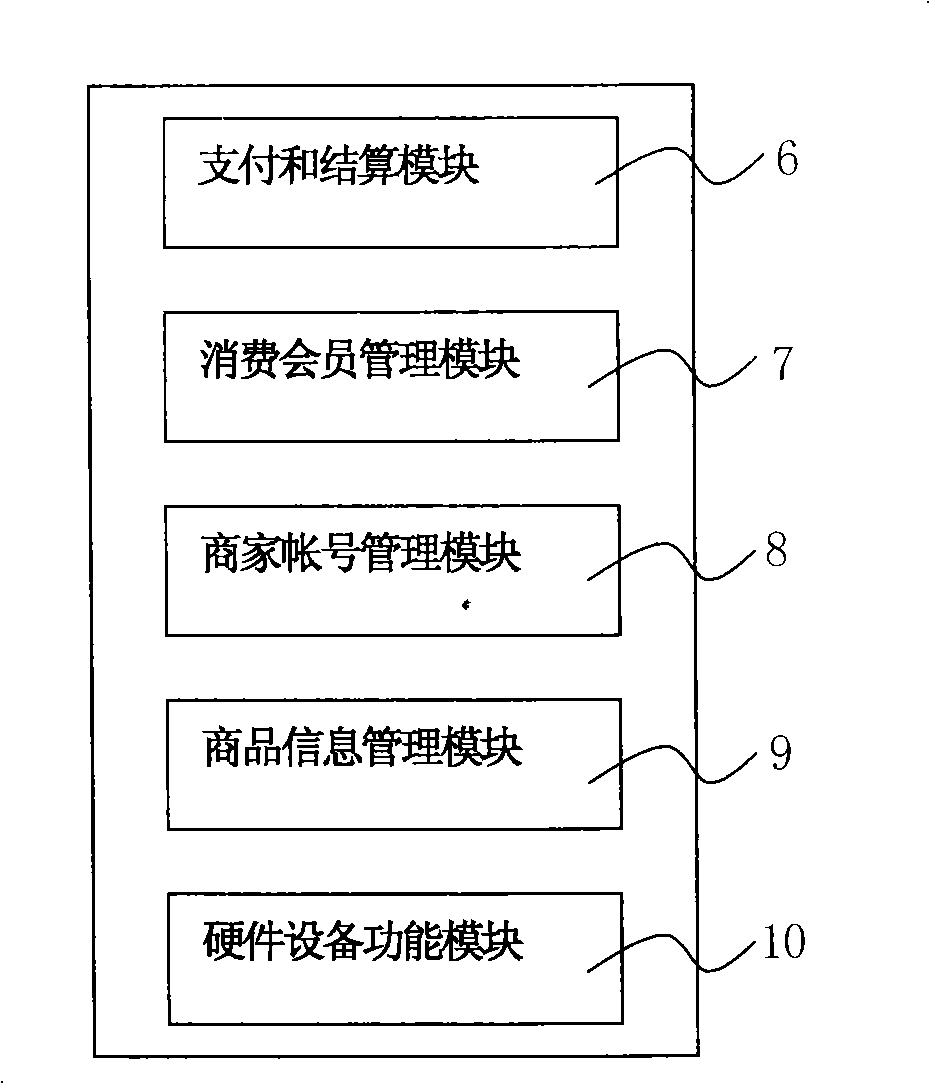

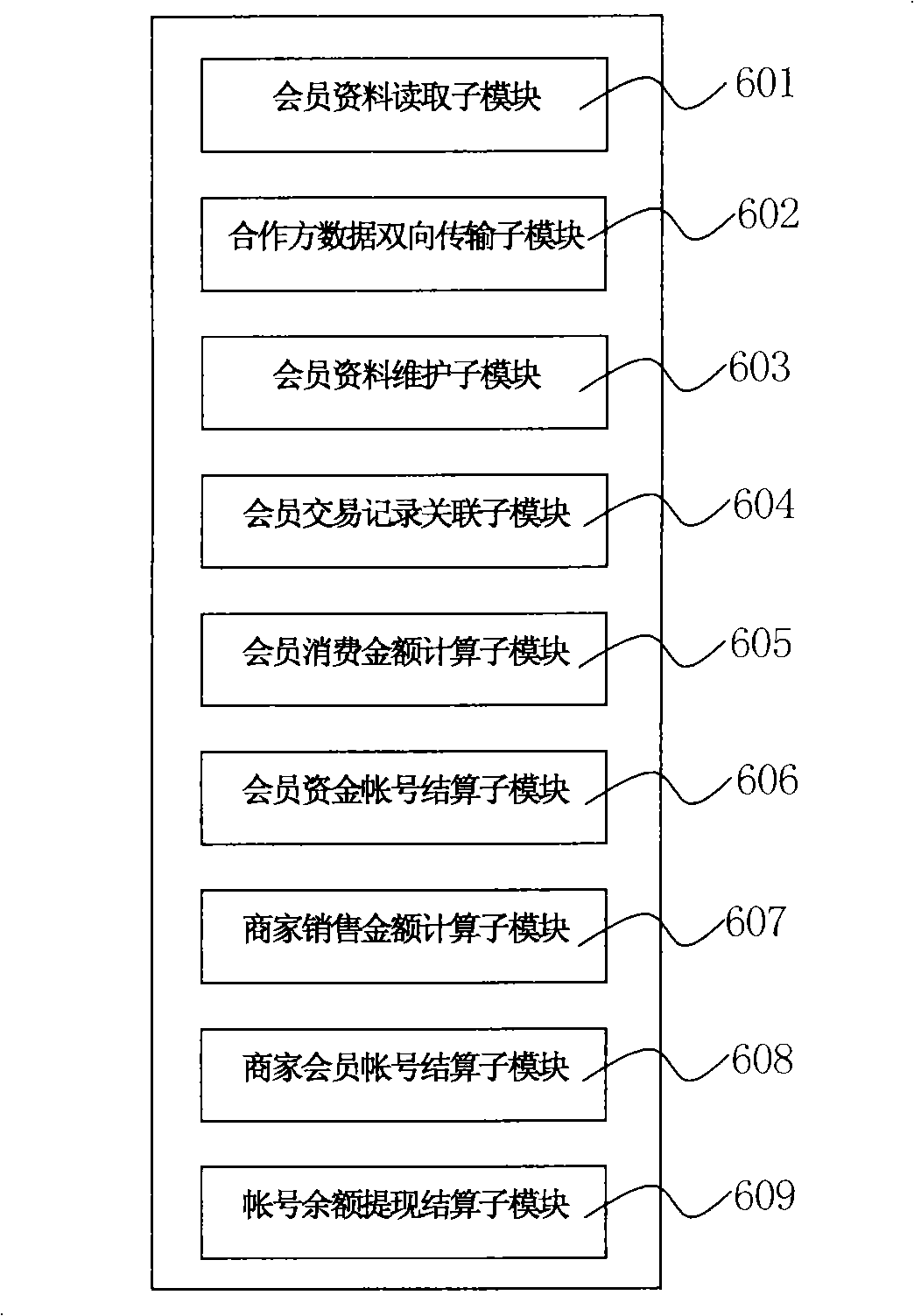

Trading stepwise affirmation payment administrative system and its payment procedure

InactiveCN101290697AHigh reputationIncrease loyaltyComplete banking machinesPayment architectureThird partyPayment order

The invention provides a transaction step confirming payment management system and a payment method for using the same, belonging to the fund transaction system and method technical field. The system comprises a magnetic card storing ID numbers of members, a card-reading device recording ID numbers of sellers and a data processing center server which is used for loading a system database and a system website. The data transmission between the card-reading device and the data processing center server is performed through a network; corresponding data is stored in the system database; the data processing center server comprises a payment and settlement module, a consumed member management module, a seller account management module, a commodity information management module and a hardware unit functional module. The payment management system as a third-party deposit platform helps a purchaser deposit consumed money, gradually confirms payment for a seller step by step during the consuming process, and provides a reliable, safe and quality guaranteed payment mode for a saving type consumption mode with longer consumption cycle.

Owner:刘 永生

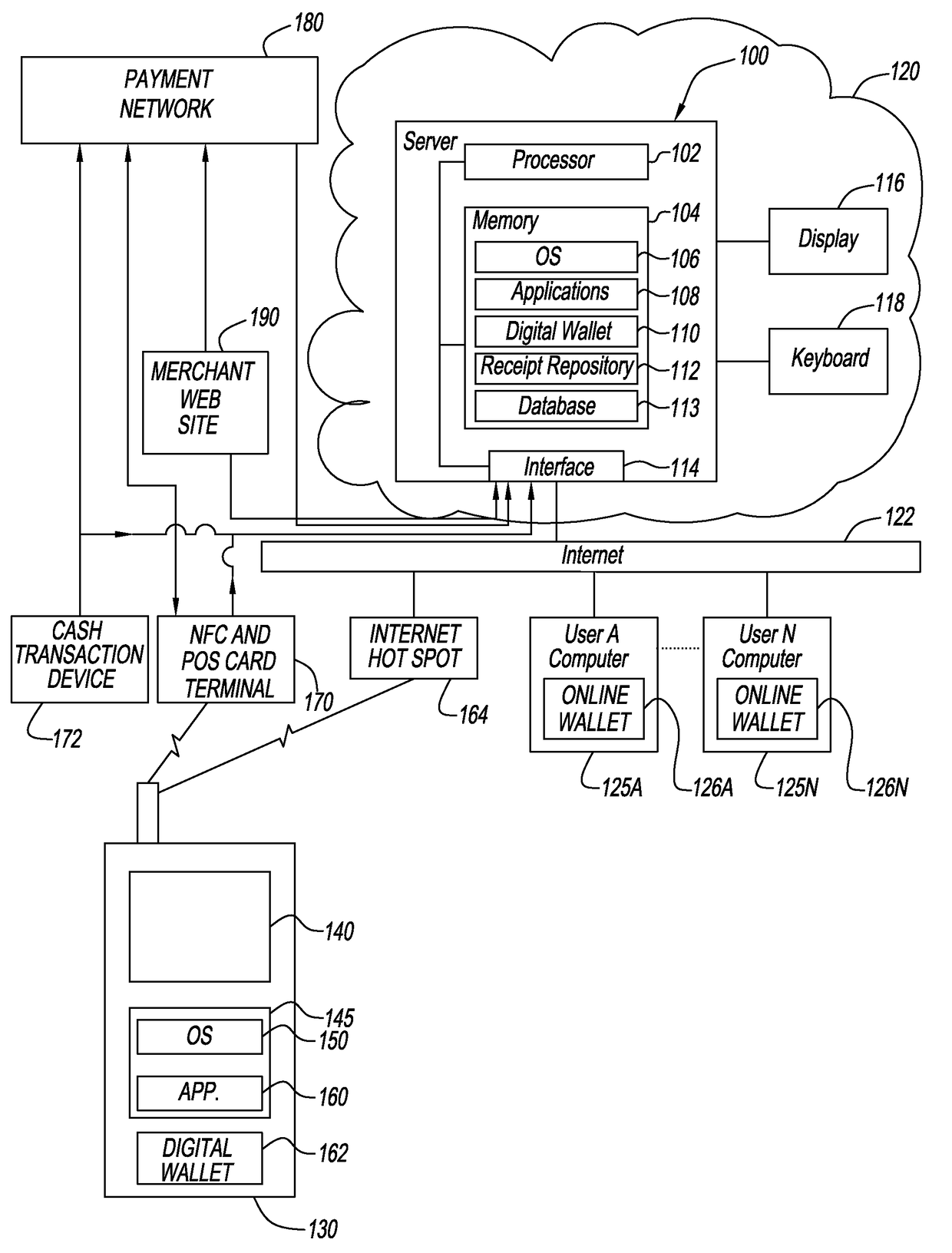

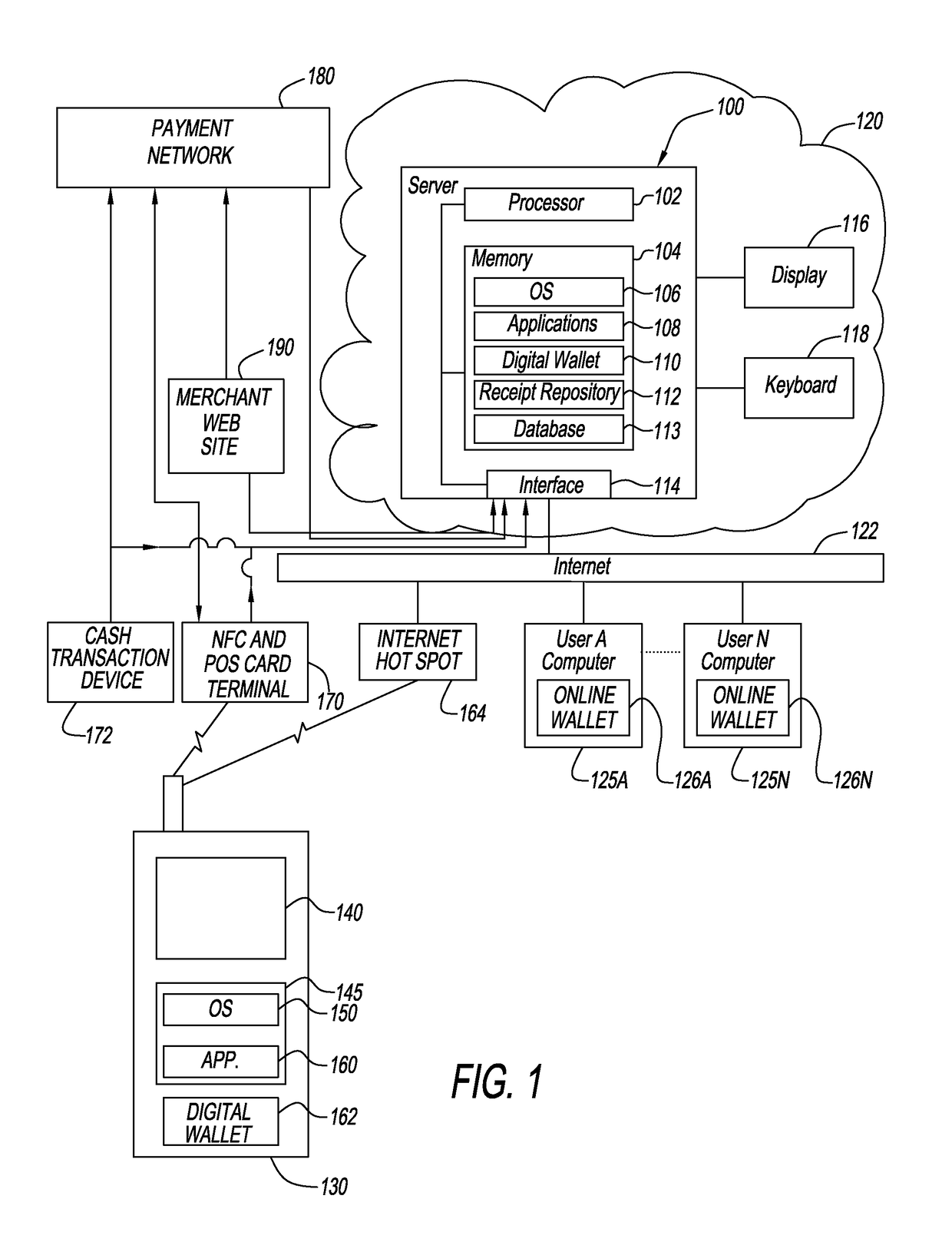

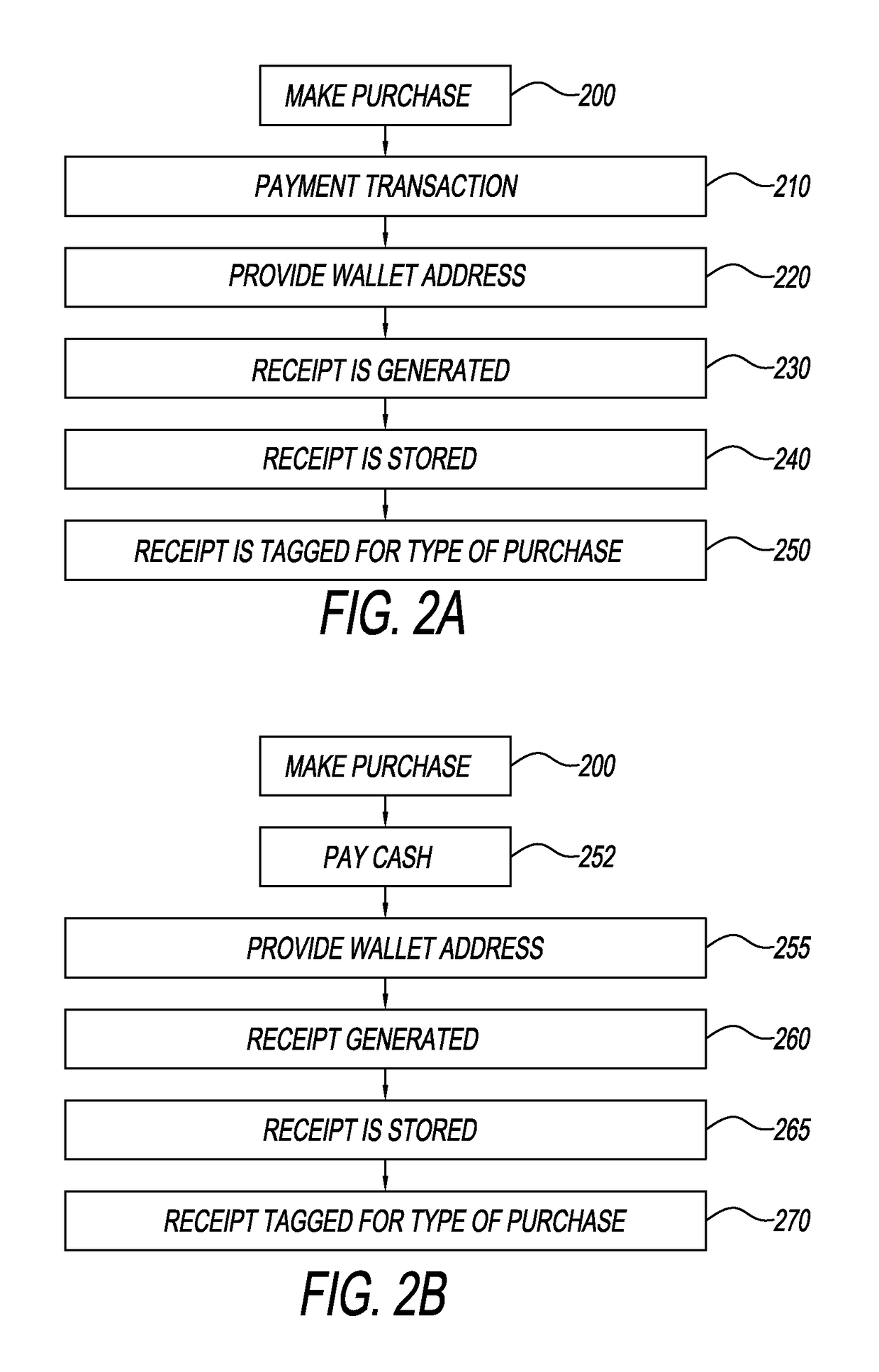

System and method for generating and storing digital receipts for electronic shopping

Owner:MASTERCARD INT INC

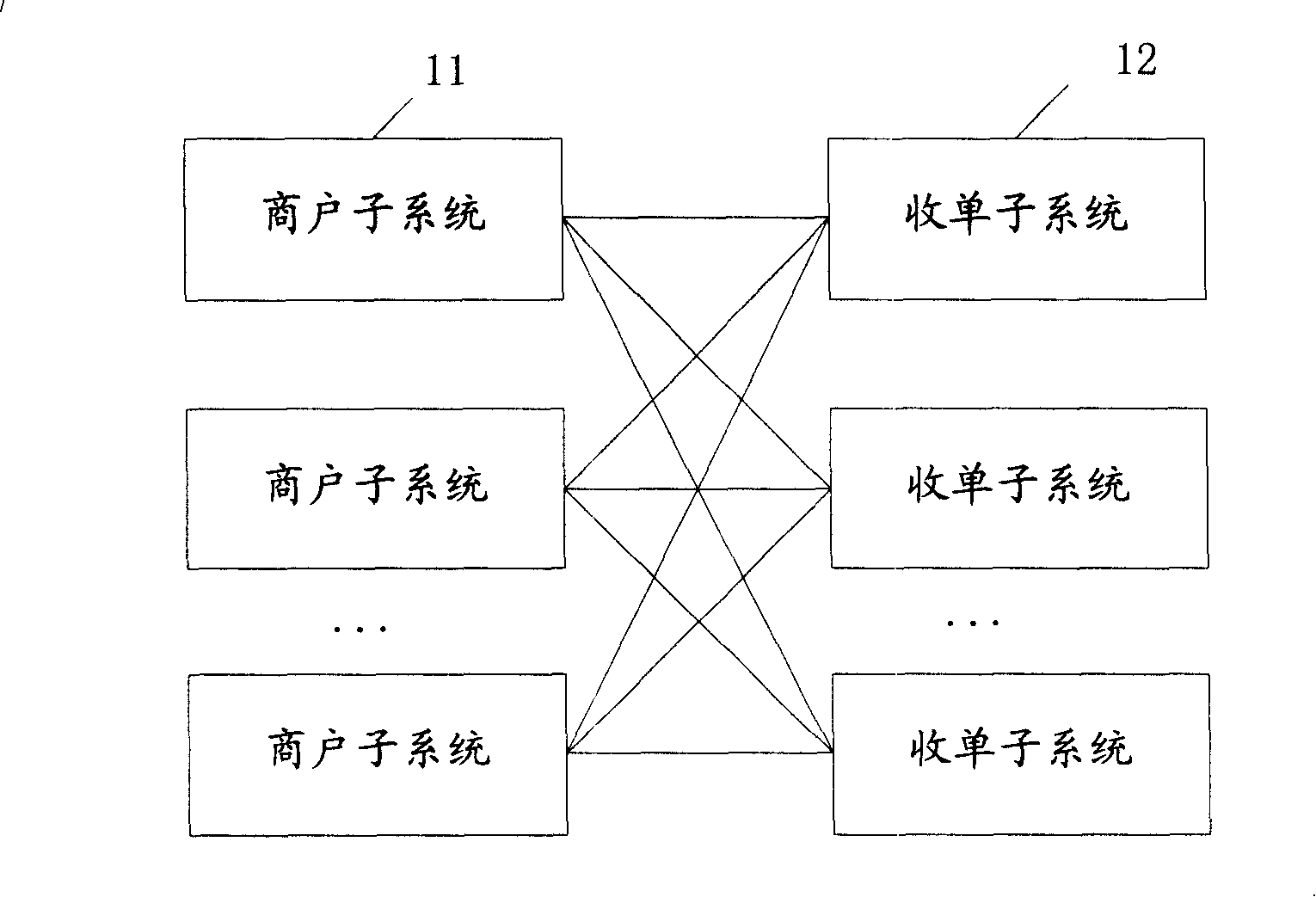

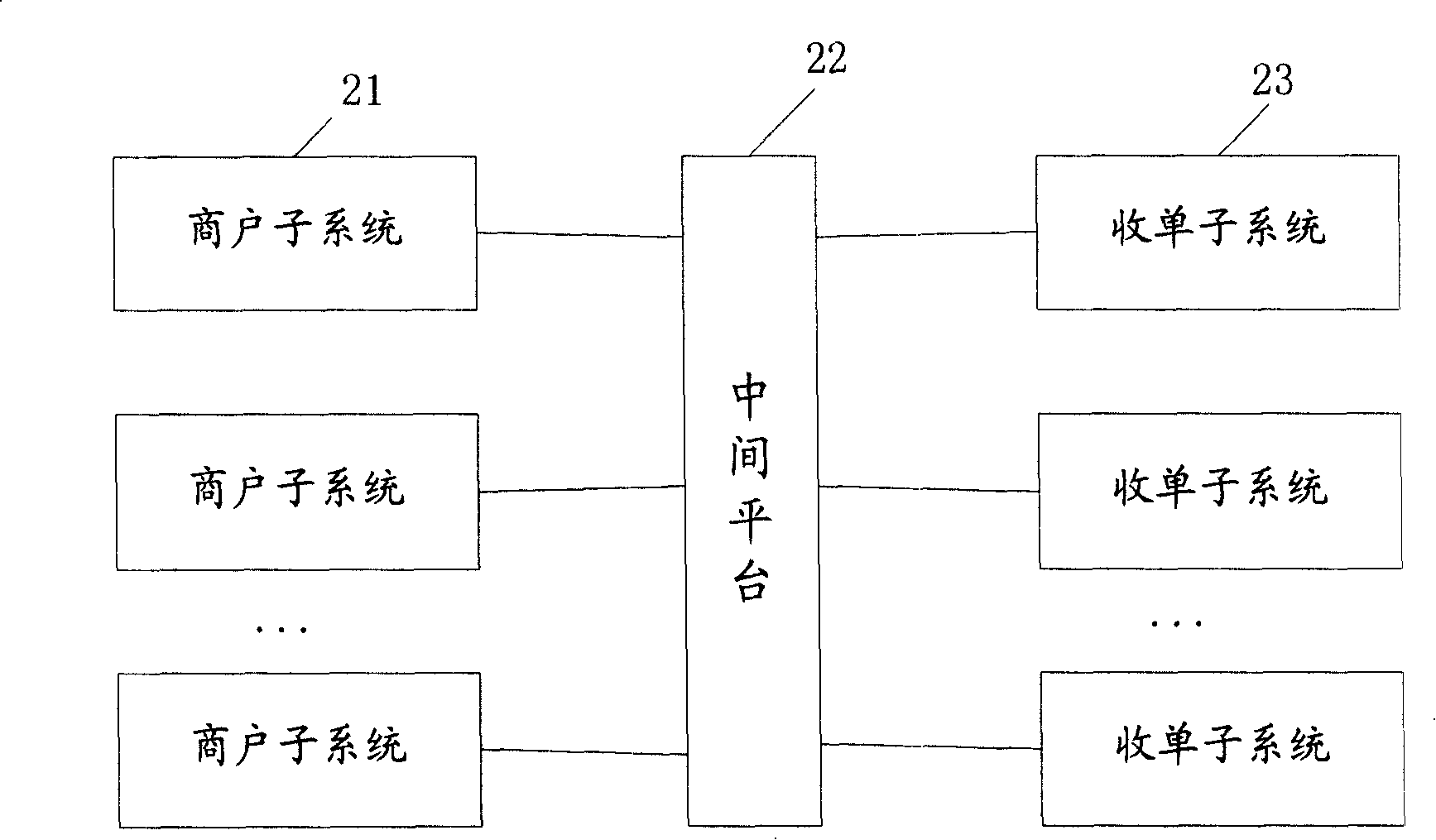

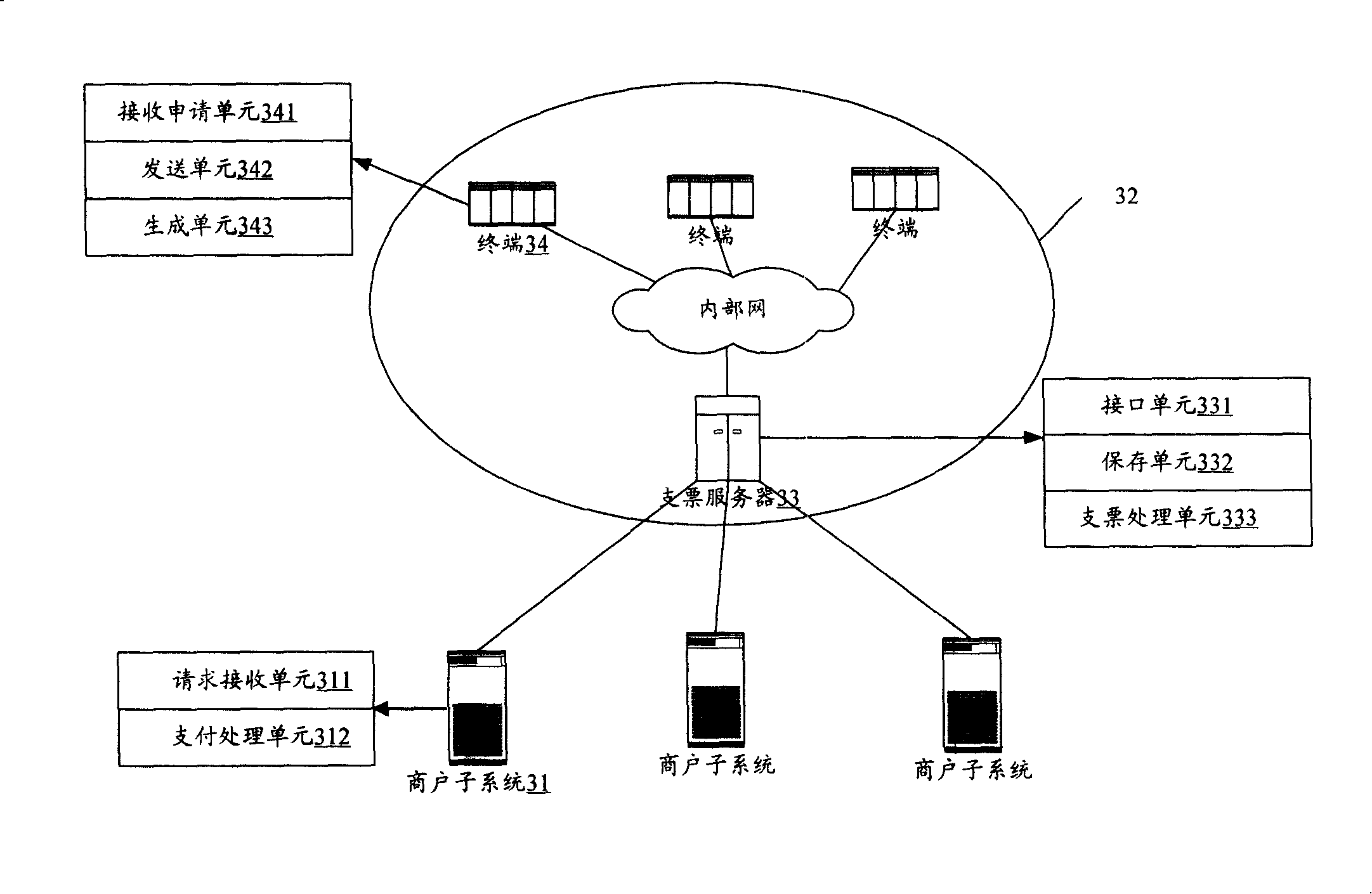

On-line payment system and payment procedure

InactiveCN101236629AEnsure safetyReduce development costsFinanceProtocol authorisationInternet privacyEngineering

The present invention discloses an online payment system comprising a merchant subsystem and an electronic cheque subsystem. The electronic cheque subsystem comprises a cheque server and a plurality of terminals. The method is that: (1) the terminal receives a cheque application request of a user to generate a number and a password of the electronic cheque firstly, and outputs the cheque number and the cheque password to the user, then returns the cheque information comprising the electronic cheque number and the cheque password and the user information inputted by the user to the cheque server to preserve; (2) the merchant subsystem receives the online payment request by which user uses the electronic cheque to process online transaction, and sends the request to the cheque server; (3) the cheque server analyzes the electronic cheque number and the cheque password from the request, and carries out withholding process after verifying the electronic cheque number and the electronic cheque password, and then returns the processing results to the merchant subsystem. The online payment system only needs to access the electronic cheque subsystem in each payment process; the flow is simple and quick. The merchant do not need to connect with the order receiving subsystem of each bank, and only need to ensure that the merchant is communicated with the electronic cheque subsystem.

Owner:ALIBABA GRP HLDG LTD

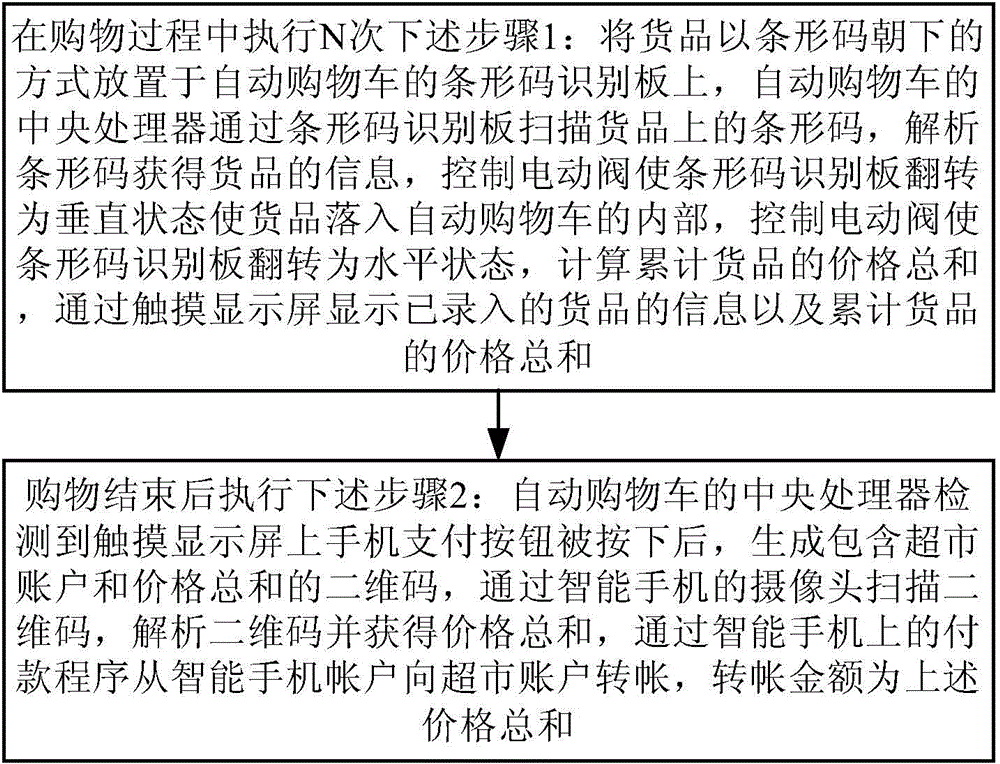

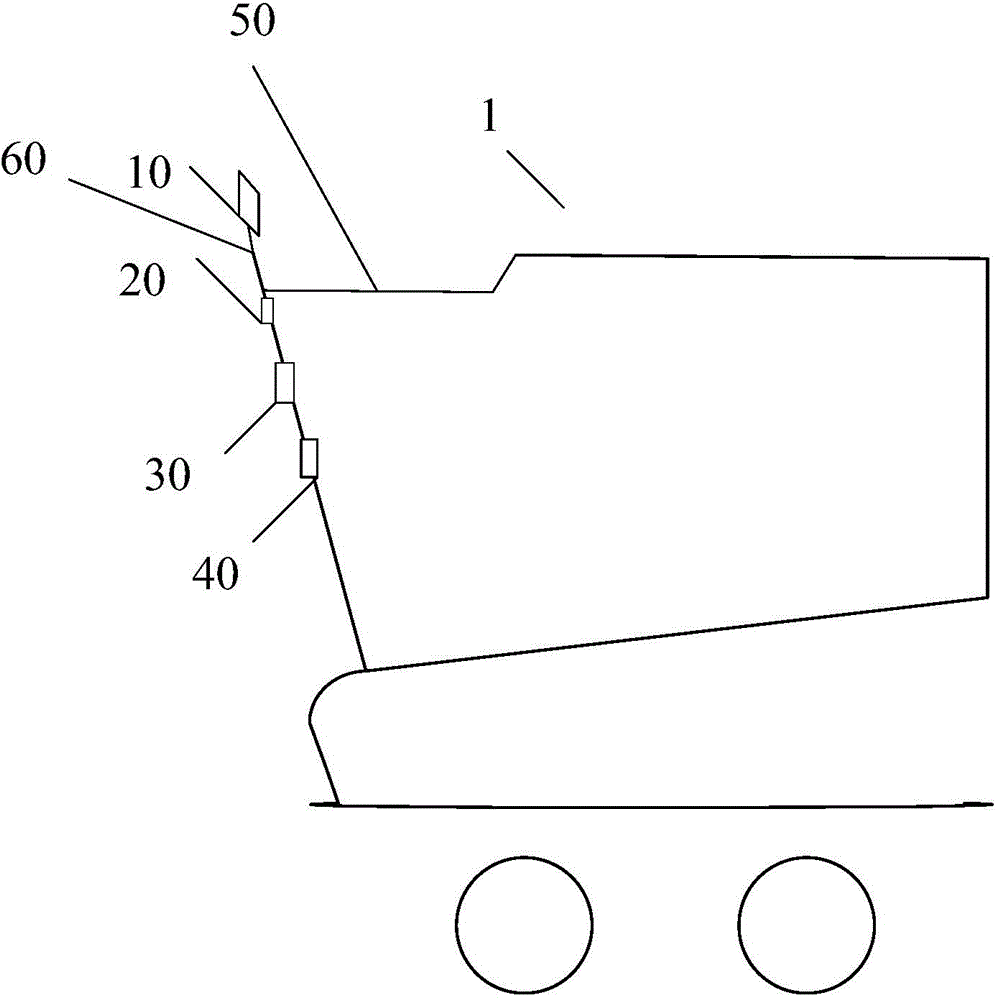

Automatic checkout method and automatic shopping cart

InactiveCN104616146AConvenient self-service shoppingEasy checkoutCash registersPayment architectureTime efficientTotal price

The invention provides an automatic checkout method and an automatic shopping cart. The method includes the steps of executing the first step N times in the shopping process, and executing the second step after the shopping ends. The second step includes the substeps of generating a two-dimensional code containing a supermarket account and the total price after a central processor of the automatic shopping cart detects that a mobile phone payment button on a touch display screen is pressed down, scanning the two-dimensional code through a camera of a smart phone, analyzing the two-dimensional code to obtain the total price, and transferring money from a smart phone account to the supermarket account through a payment program on the smart phone, wherein the transferred money equals to the total price. Consumers can conveniently conduct self-service shopping and checkout without queuing, time can be saved, and the shopping experience of the consumers can be improved.

Owner:郅天奇

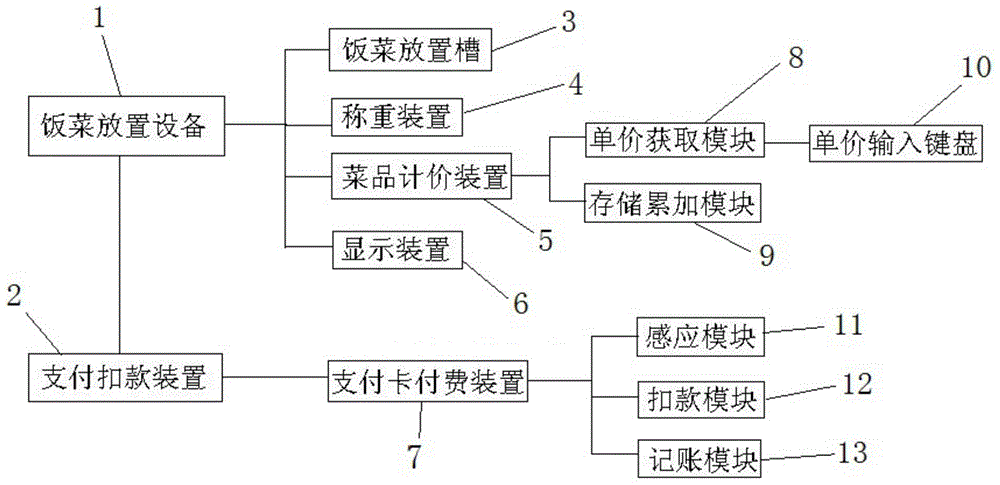

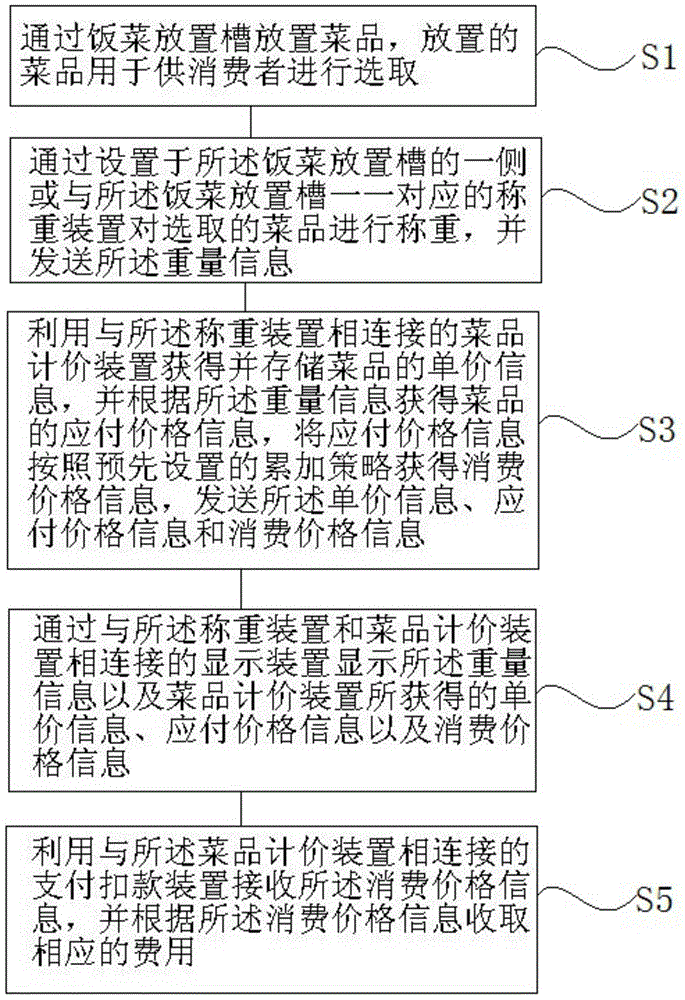

Dish management consumption system and method

ActiveCN104966353AAchieve weighingRealization of weighing and pricingCoin-freed apparatus detailsPayment architectureDisplay deviceEmbedded system

The invention discloses a dish management consumption system and method. The dish management consumption system comprises a dish carrying device and a payment device. The dish carrying device is provided with a plurality of dish carrying grooves, a weighing device, a dish pricing device and a displaying device. The dish management consumption method comprises the following steps that dishes are selected from placed dishes; the selected dishes are weighed, the dish pricing device is used for calculating the payable price information of the weighed dishes, and the consumption price information is acquired; the payment device is used for charging the corresponding expenditure. The dish management consumption system and method have the advantages that since the dish carrying device is provided with the weighing device, the dish pricing device and the displaying device, the dishes can be effectively weighed, consumers can select the corresponding dishes according to the preconceived appetite, and the phenomenon that the dishes are left or are not enough is effectively avoided; the payment procedures are simplified, the time and the labor cost are saved, and the working efficiency is improved.

Owner:悦来湖(山东)数字经济产业园运营管理有限公司

Systems and methods for bank determination and payment handling

Systems and methods are provided for automated payment handling. In one implementation, a method is provided for processing of a payment request. The method may include determining, using the payment request, an entity that will receive a payment, and determining an outgoing bank account to use for the payment. Further, the method may include automatically selecting, from a list of available payment procedures, a preferred payment procedure for the payment request, the preferred payment procedure indicating a payment form code and a connection with the entity. Moreover, the method may include validating the preferred payment procedure using a set of rules and paying, to the entity, the payment using the validated payment procedure.

Owner:SAP AG

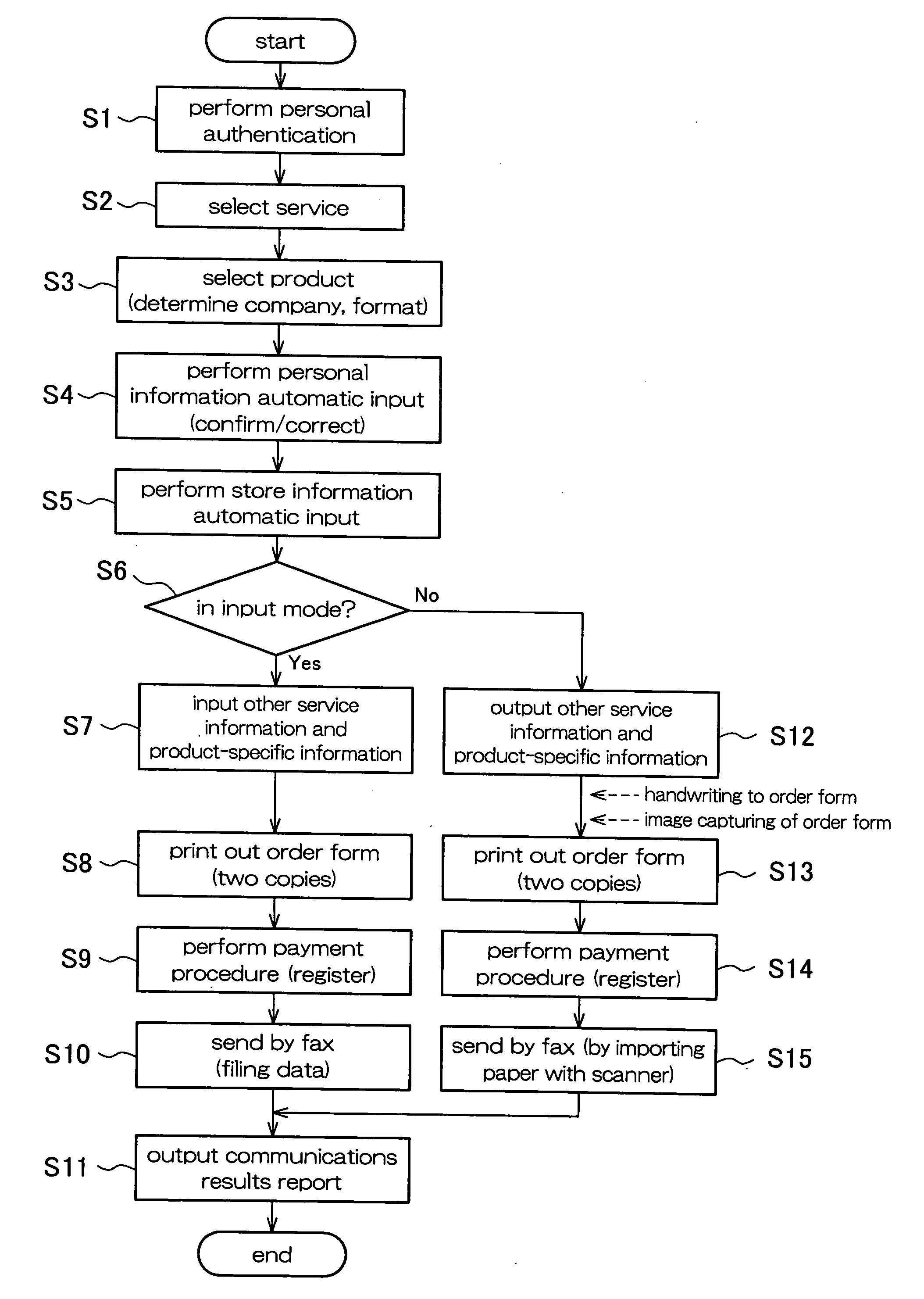

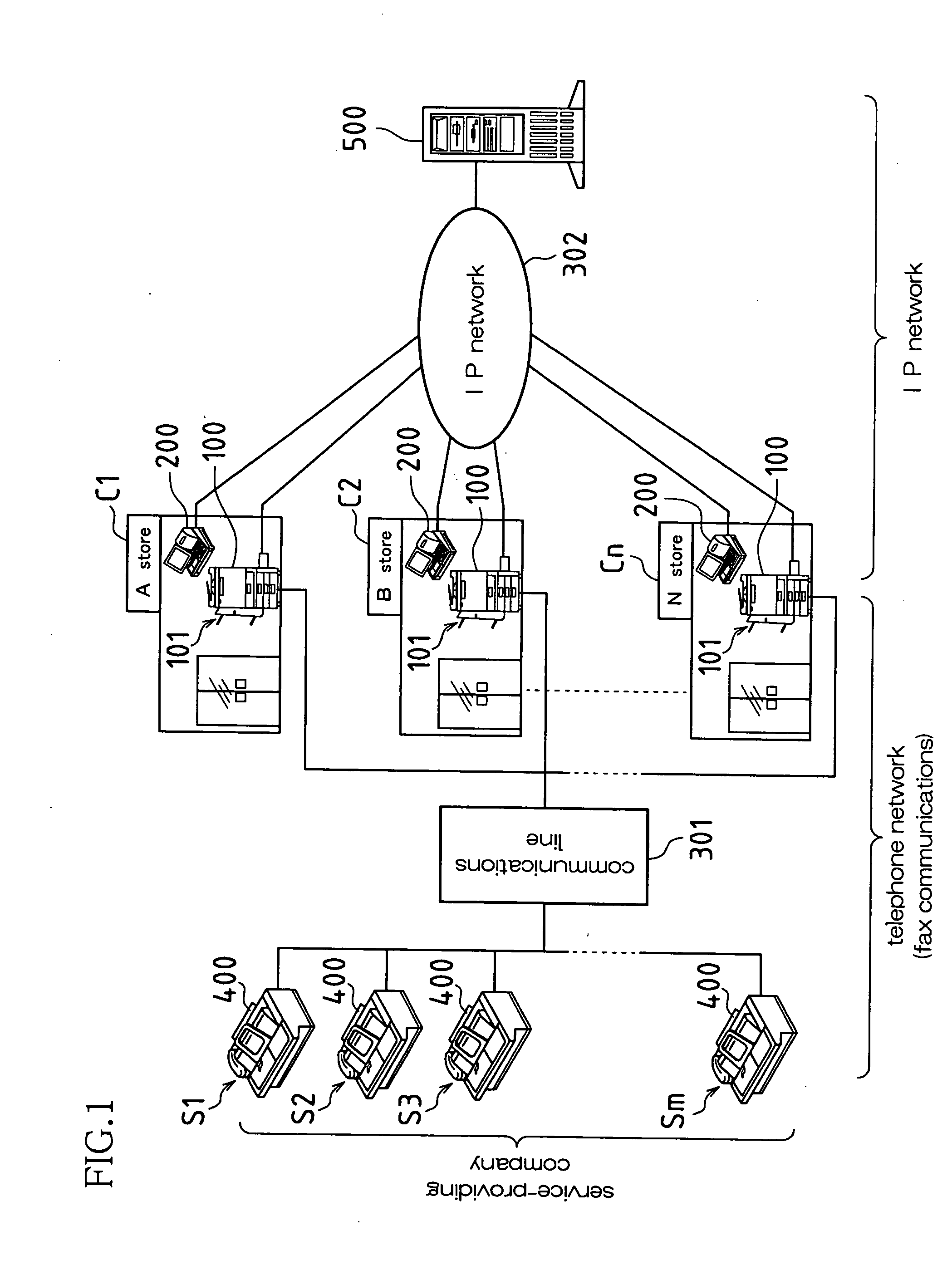

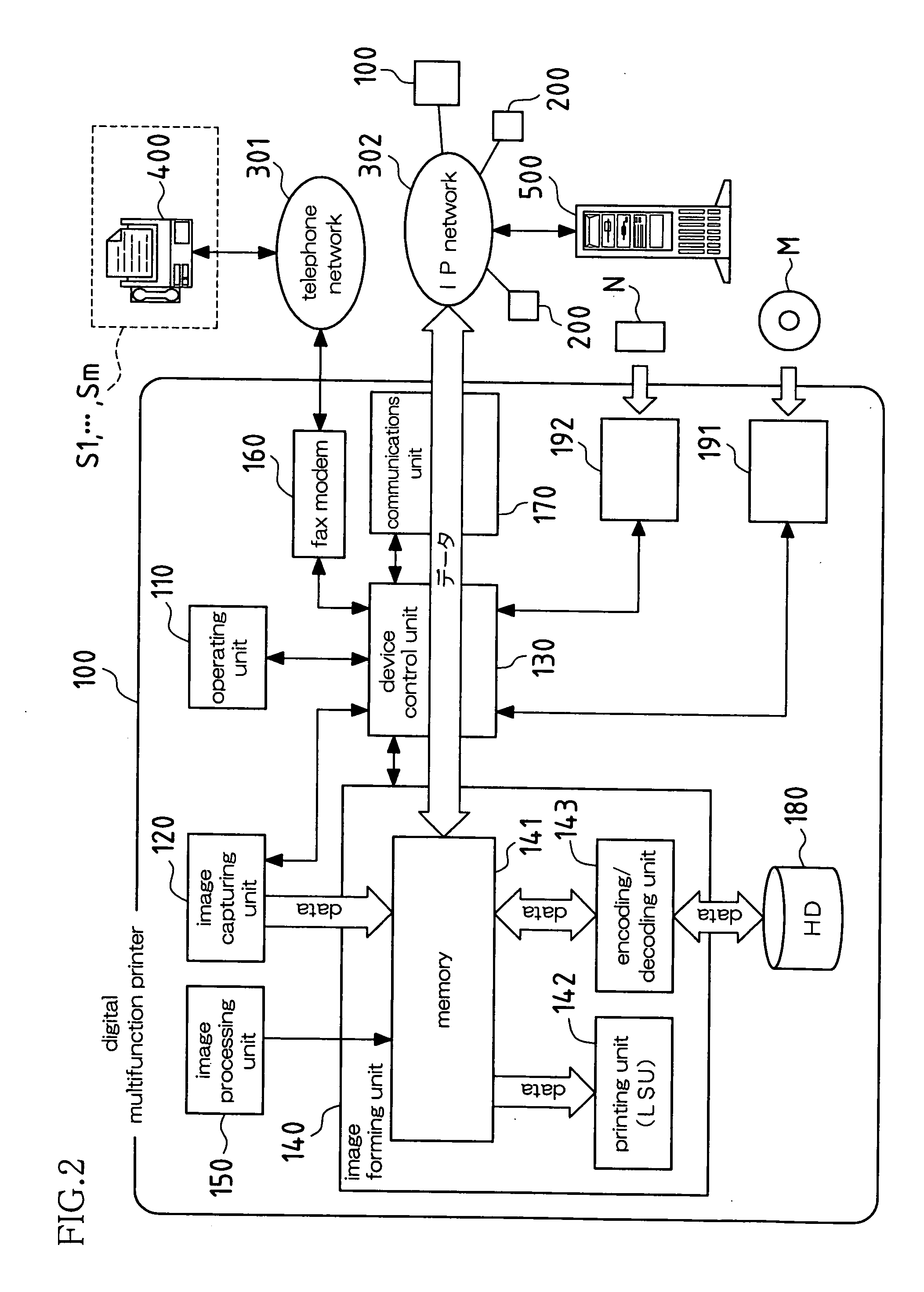

Product ordering apparatus

InactiveUS20090099937A1Reduce the amount requiredAccurate and effectiveCash registersPayment architectureProduct orderOrder form

In one embodiment of a product ordering apparatus, information of a service entrusted from a service-providing company is selected from an operating unit, and when product information in that service is selected from the operating unit, the service-providing company is designated, the format of an order form is determined by designating the service-providing company, personal information and store information are automatically input along with product information to data of the determined order form, and after a payment procedure in a settlement device, order form data in which the information has been automatically entered is automatically sent by facsimile to a device of the service-providing company due to a request from the settlement device, and after sending the facsimile, when outputting a communications results report, the contents of the order form are printed on paper as a copy together with the communications results report.

Owner:SHARP KK

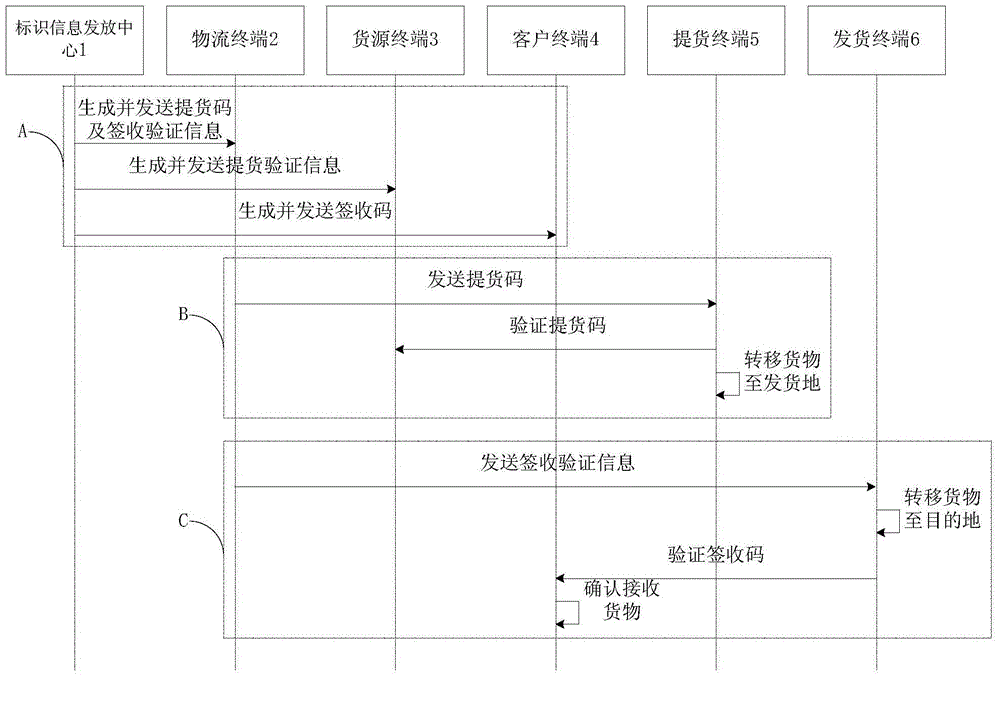

System and method for logistics verification

InactiveCN104838395AEasy to realize automatic sending and receivingImprove intelligenceBuying/selling/leasing transactionsLogisticsLogistics managementThe Internet

Owner:SHENZHEN CIFPAY NETWORK BANK TECH

Infra-red ray mobile phones payment terminal, payment procedure and system

InactiveCN101339684AReduce riskPrivacy protectionComplete banking machinesClose-range type systemsComputer terminalMobile payment

The invention discloses an infrared mobile phone payment terminal, a payment method and a payment system which are designed for solving the problems that the payment mode of the existing mobile phone is complicated to be operated and is easy to get wrong. The system comprises a payer mobile phone terminal, a payee mobile phone terminal and a bank network mobile payment server; the payee mobile phone terminal is used for sending a payment request to the payer mobile phone terminal by an infrared signal; the payer mobile phone terminal is used for receiving the payment request and sending a payment instruction to the bank network mobile payment server based on the payment request; the bank network mobile payment server is used for receiving the payment request, processing the related financial information and sending the operation result to the payee mobile phone terminal and the payer mobile phone terminal. The infrared mobile phone payment terminal, the payment method and the payment system of the invention are suitable for the consumption settlement between the consumers and the shops, and also are suitable for the payment transfer between individuals.

Owner:BEIJING AIO TIME INFORMATION TECH

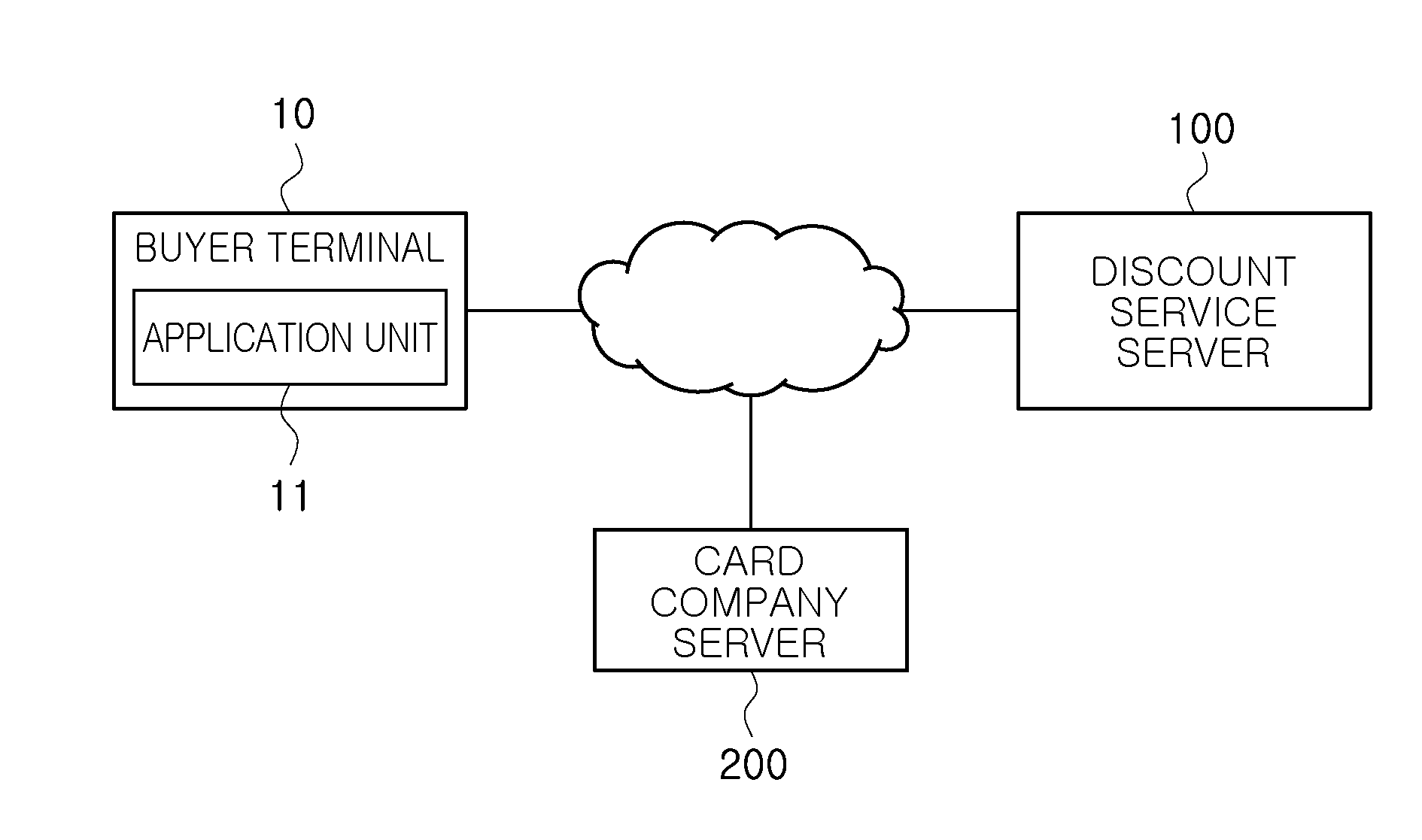

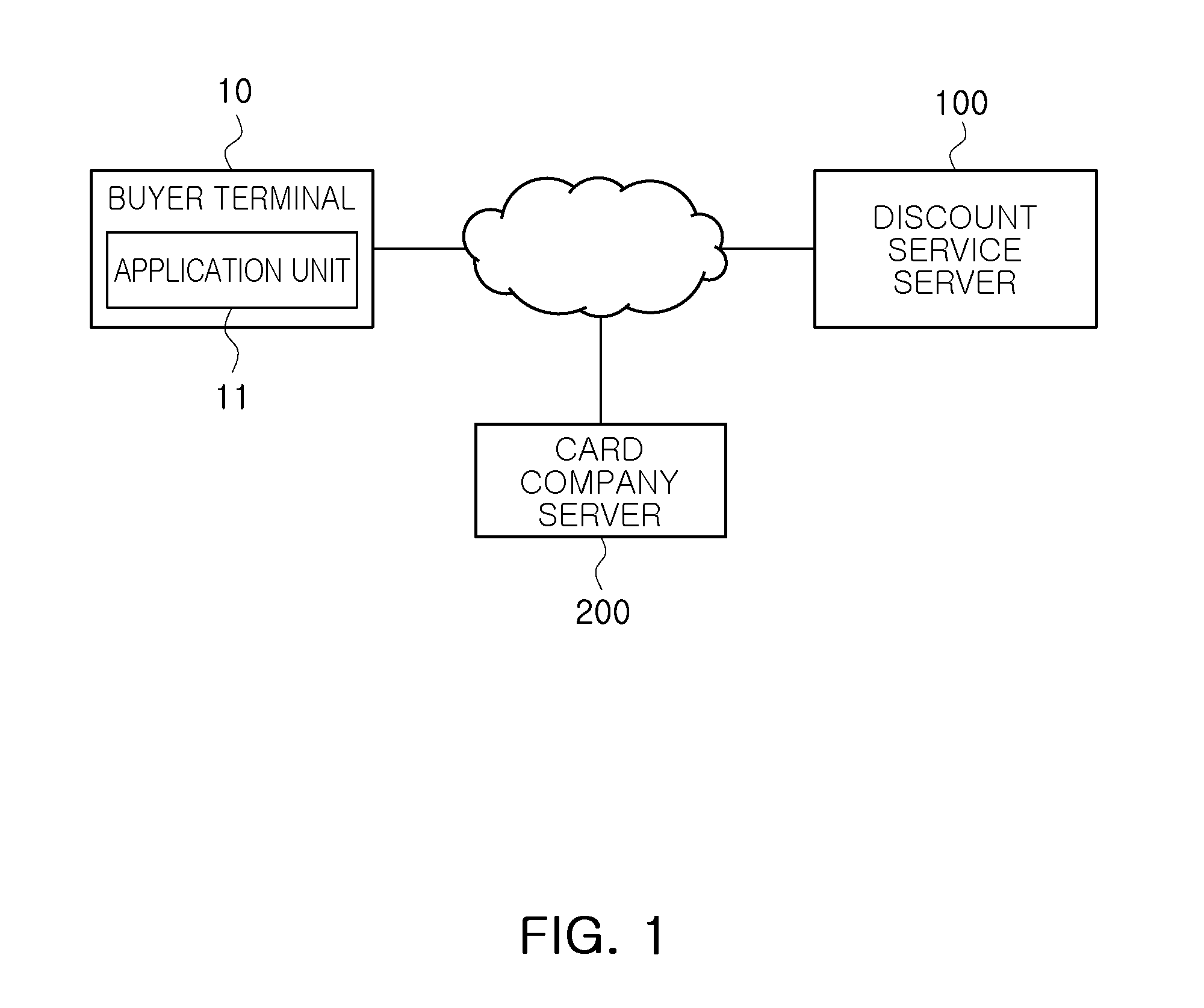

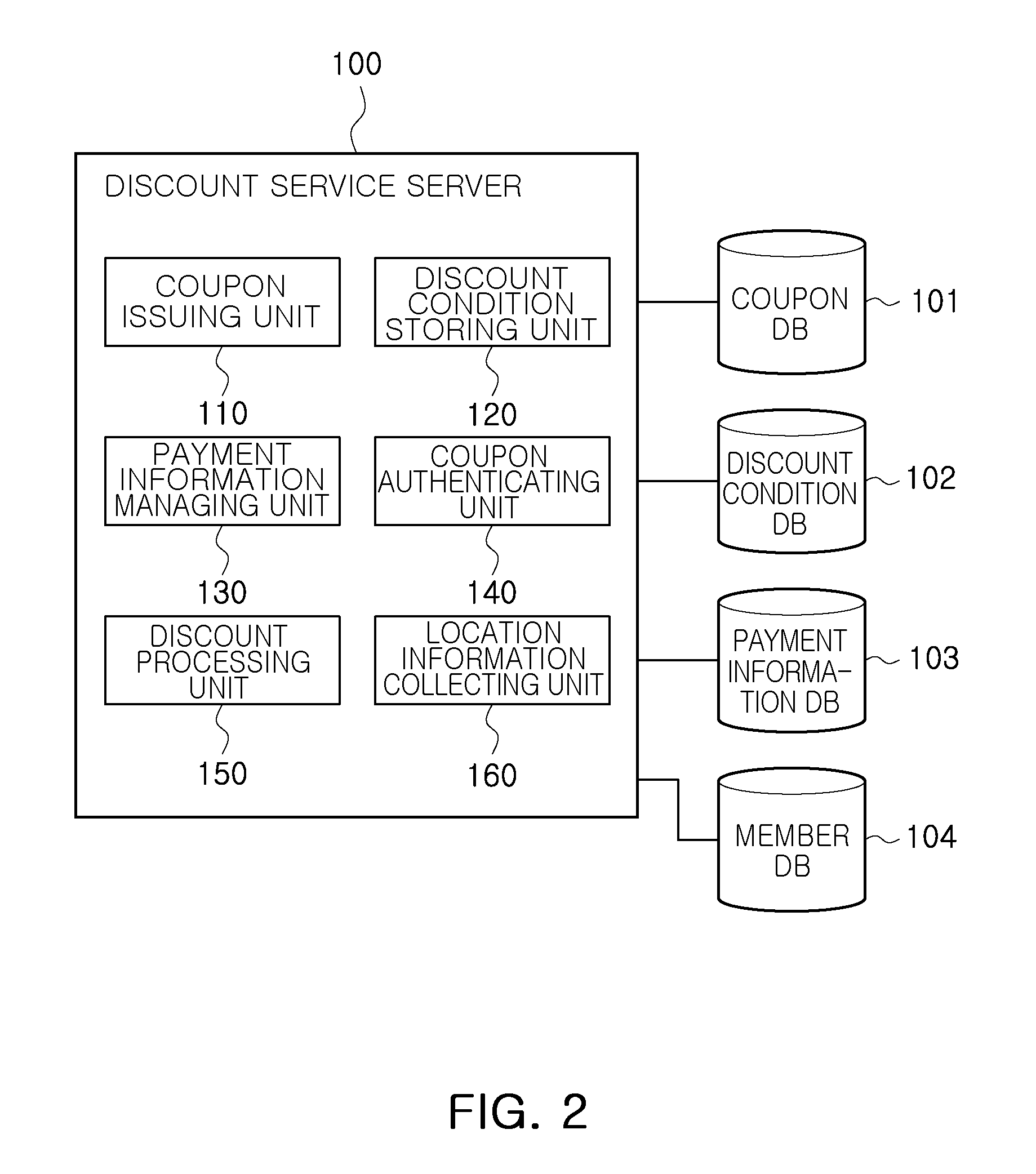

Discount service system and method according to discount conditions

InactiveUS20160343018A1Profit maximizationImprove satisfactionMarketingComputer sciencePayment procedure

The present invention relates to a discount service system and method according to a discount condition which defers the payment in accordance with the coupon purchase of a buyer, and changes the payment to a discount condition related with the coupon usage at the time of performing the payment to process the payment amount. According to the present invention, a payment procedure of the coupon purchased by the buyer is deferred later than the coupon used time or coupon usage and various discount conditions is set to apply additional benefit in accordance with the coupon usage of the seller to provide a discount in accordance with a discount condition in connection with the coupon usage of the buyer, to guide the buyer to use a coupon in a seller's desired direction, thereby maximizing the benefit of the seller.

Owner:IVYBERRY

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com