Patents

Literature

192 results about "Service company" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

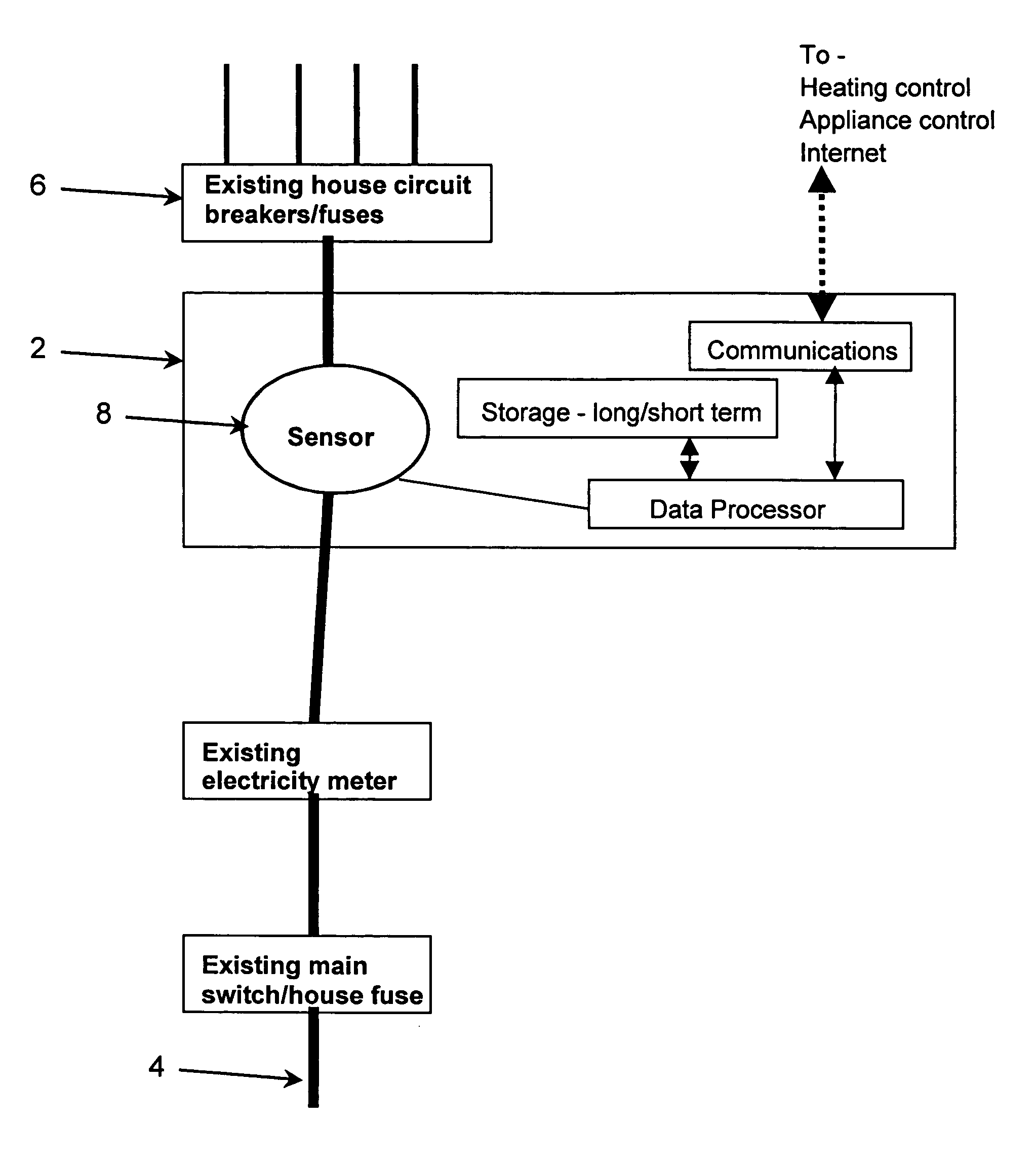

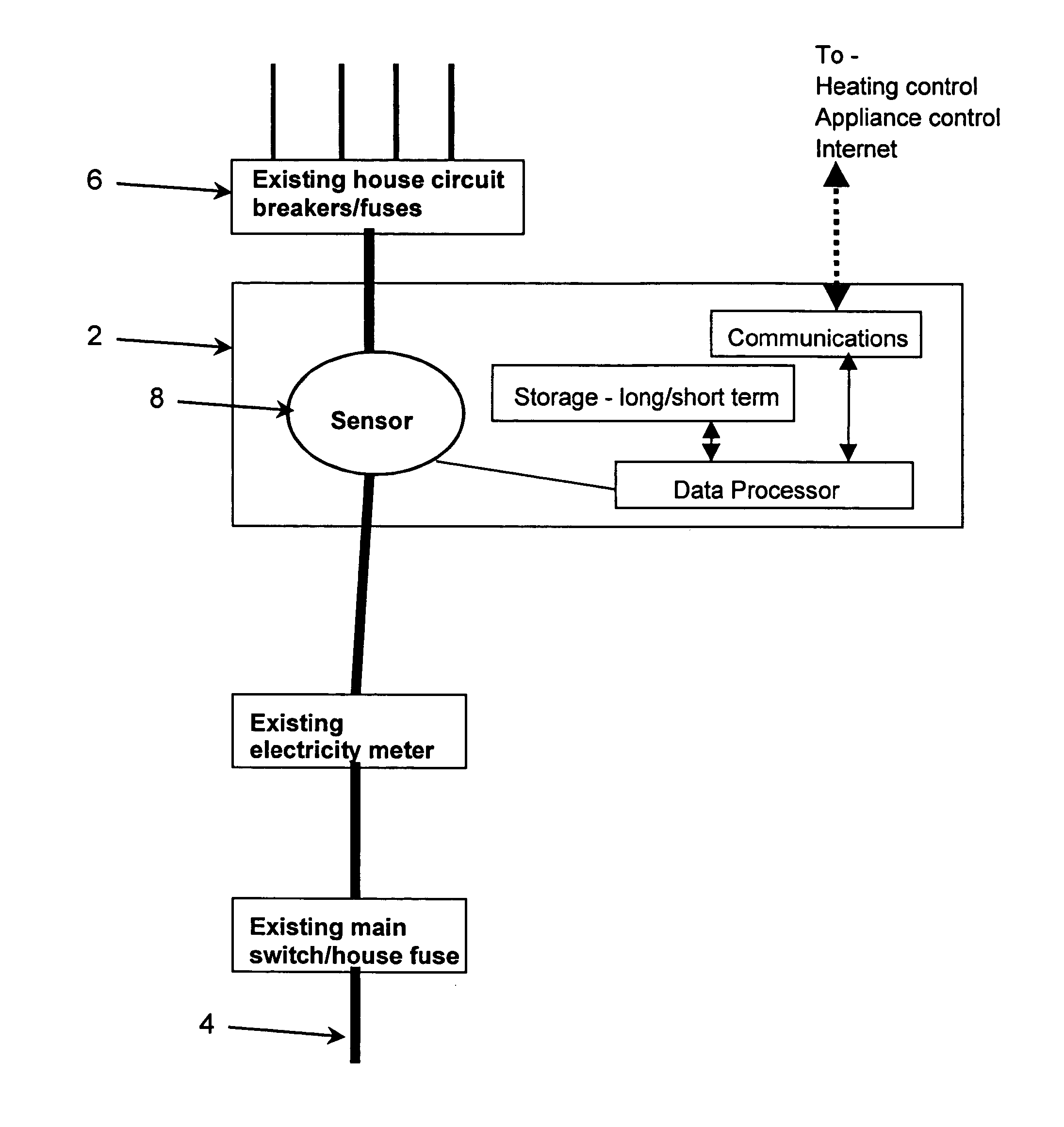

Household energy management system

ActiveUS20050171645A1Reduce energy costsReduce the amount requiredLevel controlTemperatue controlElectricityProcess engineering

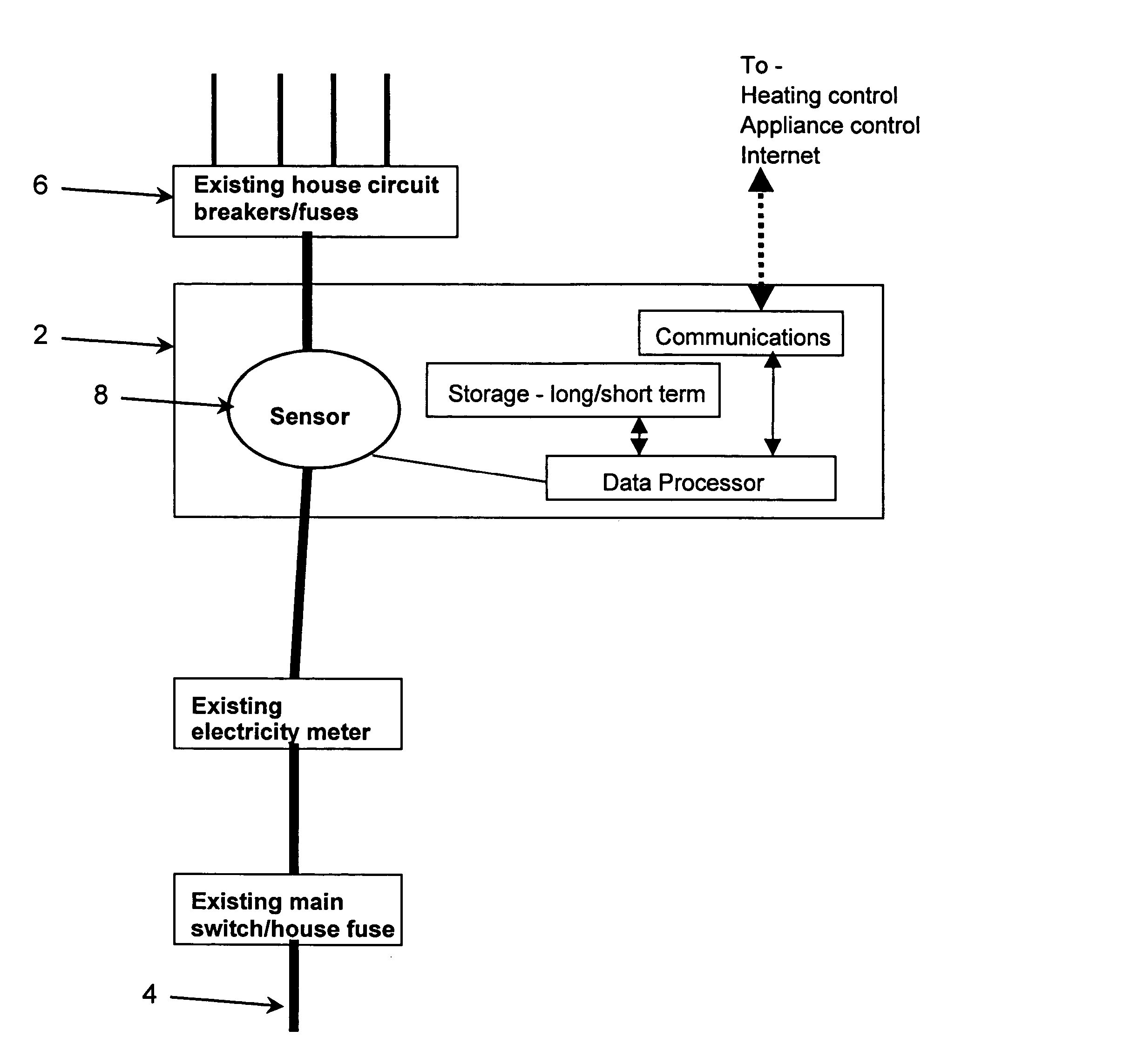

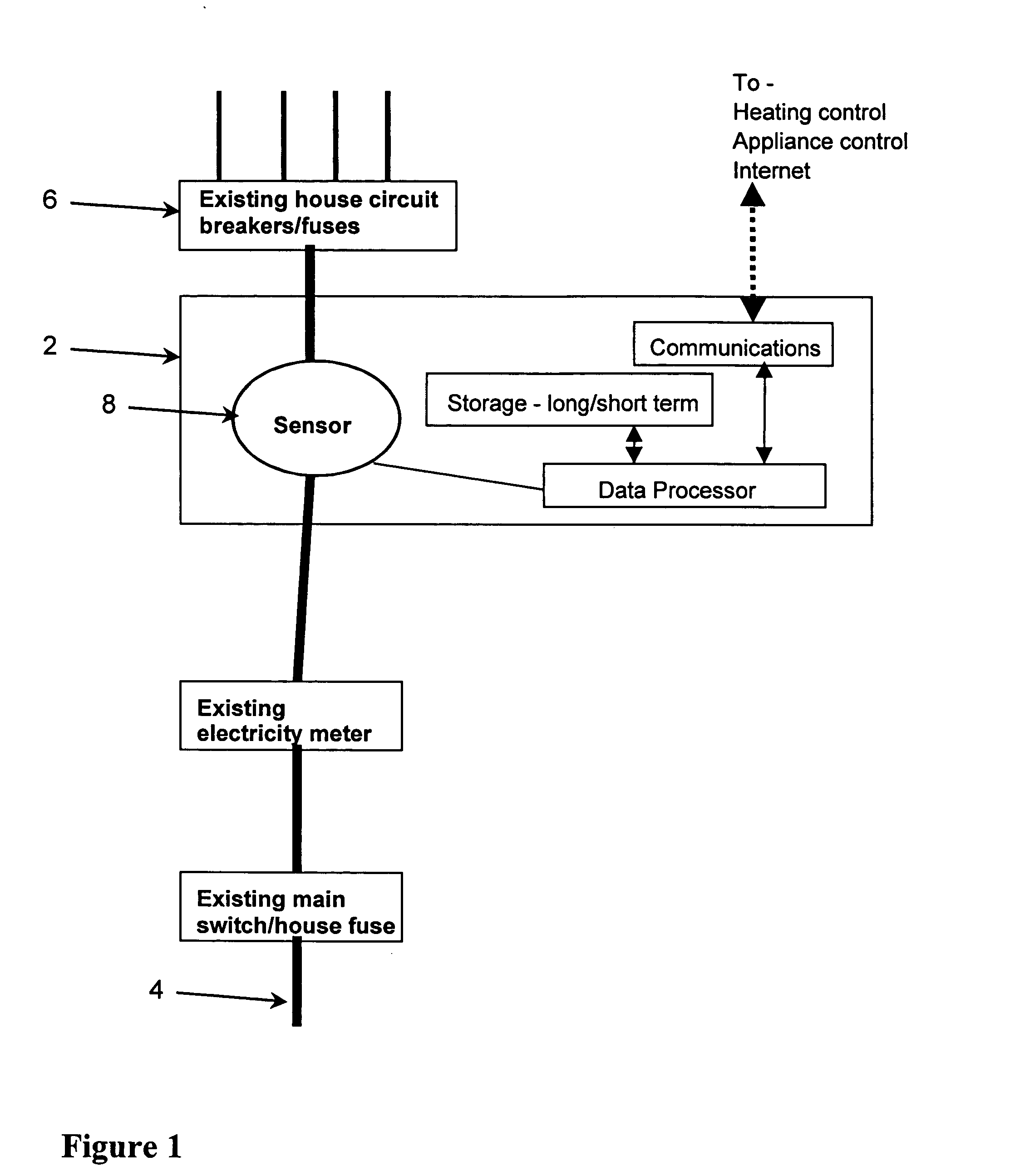

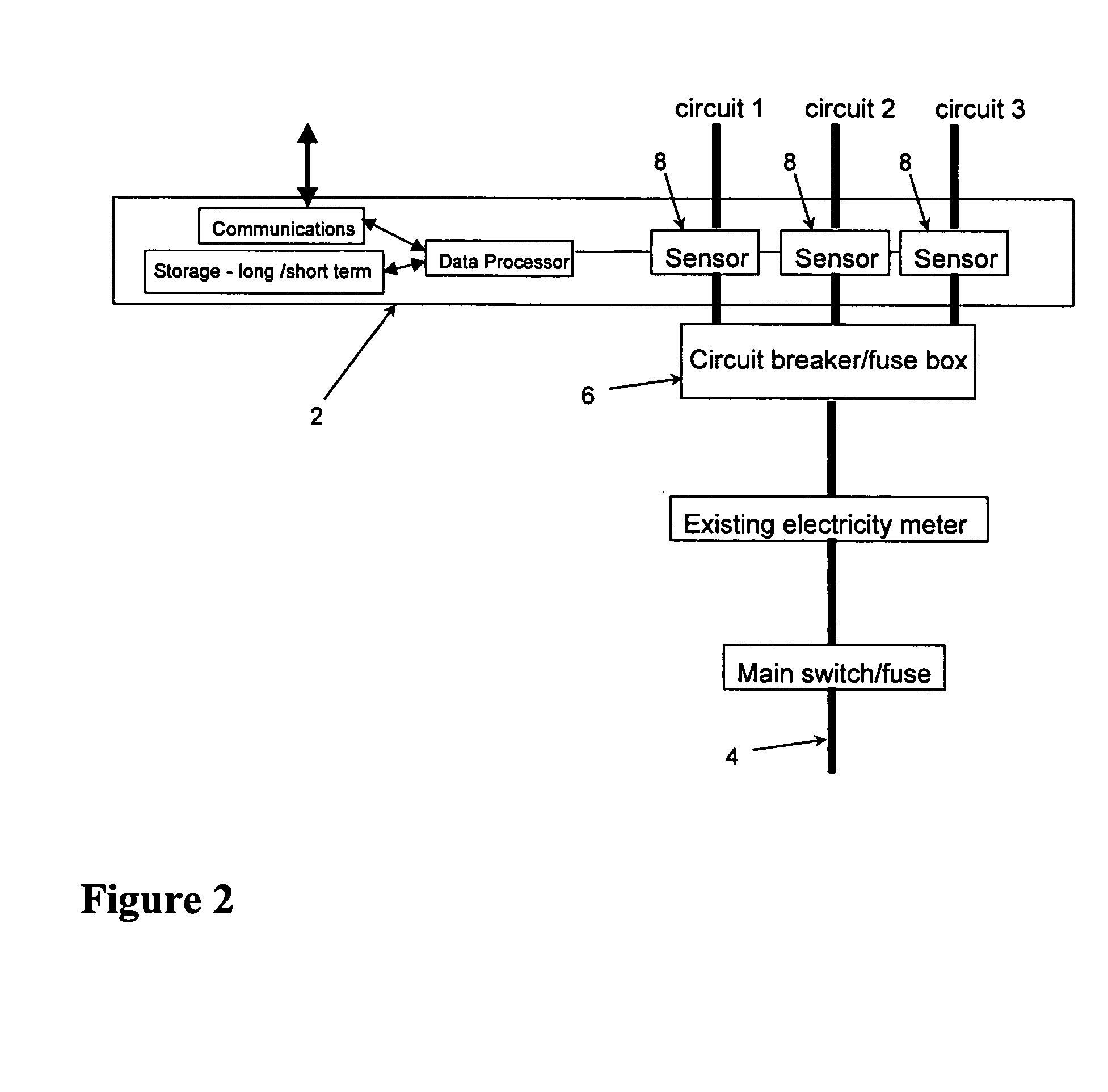

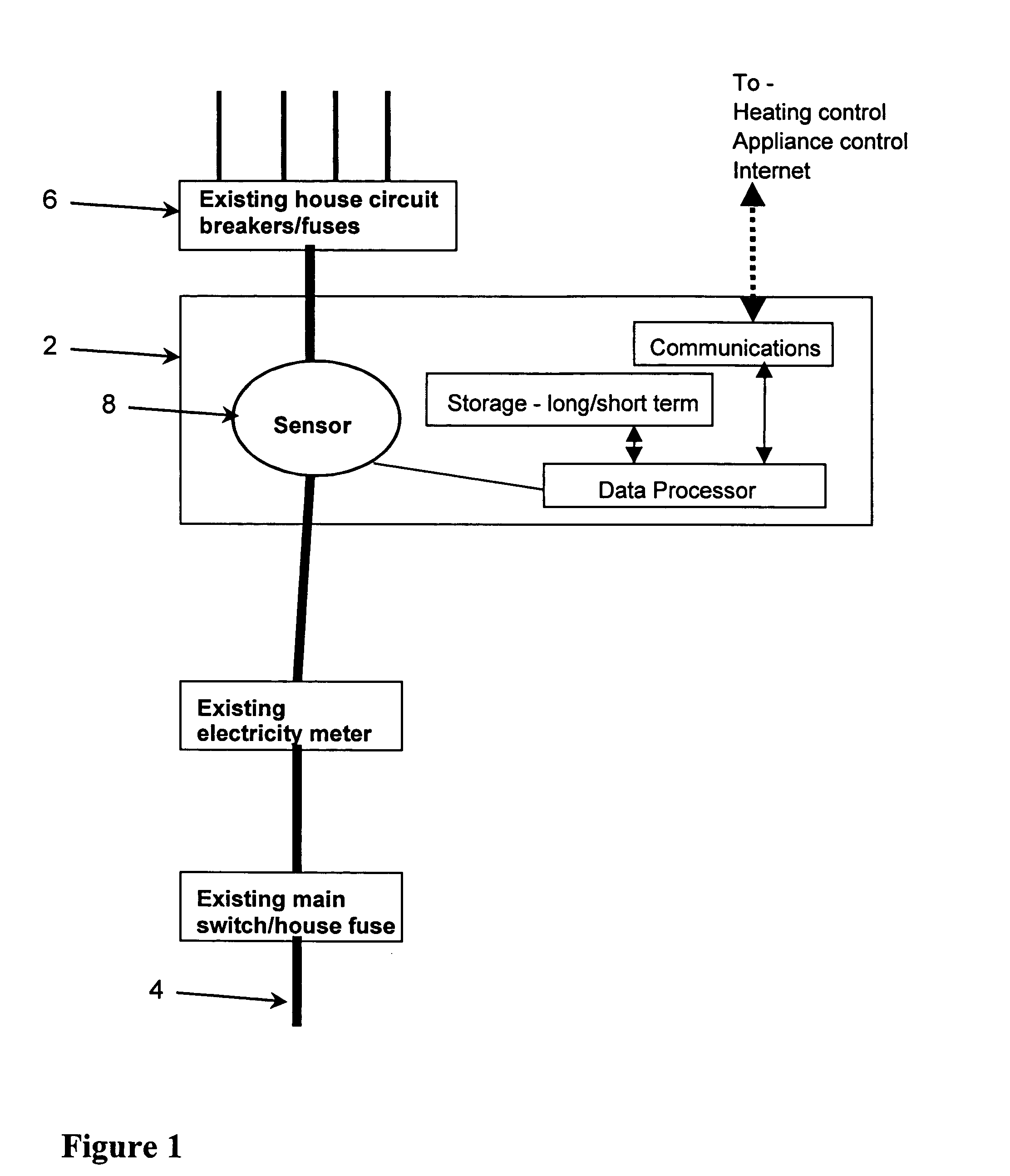

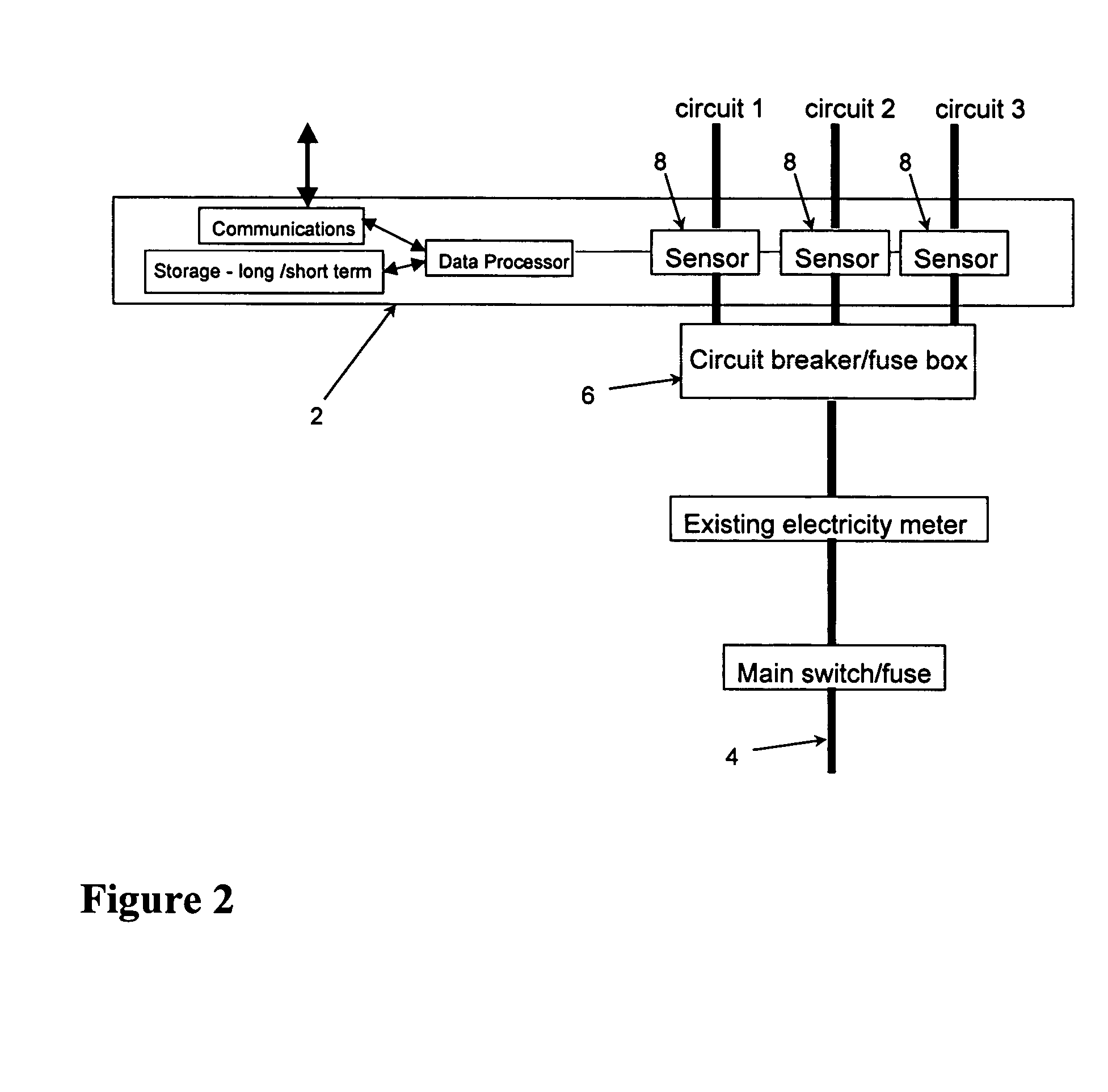

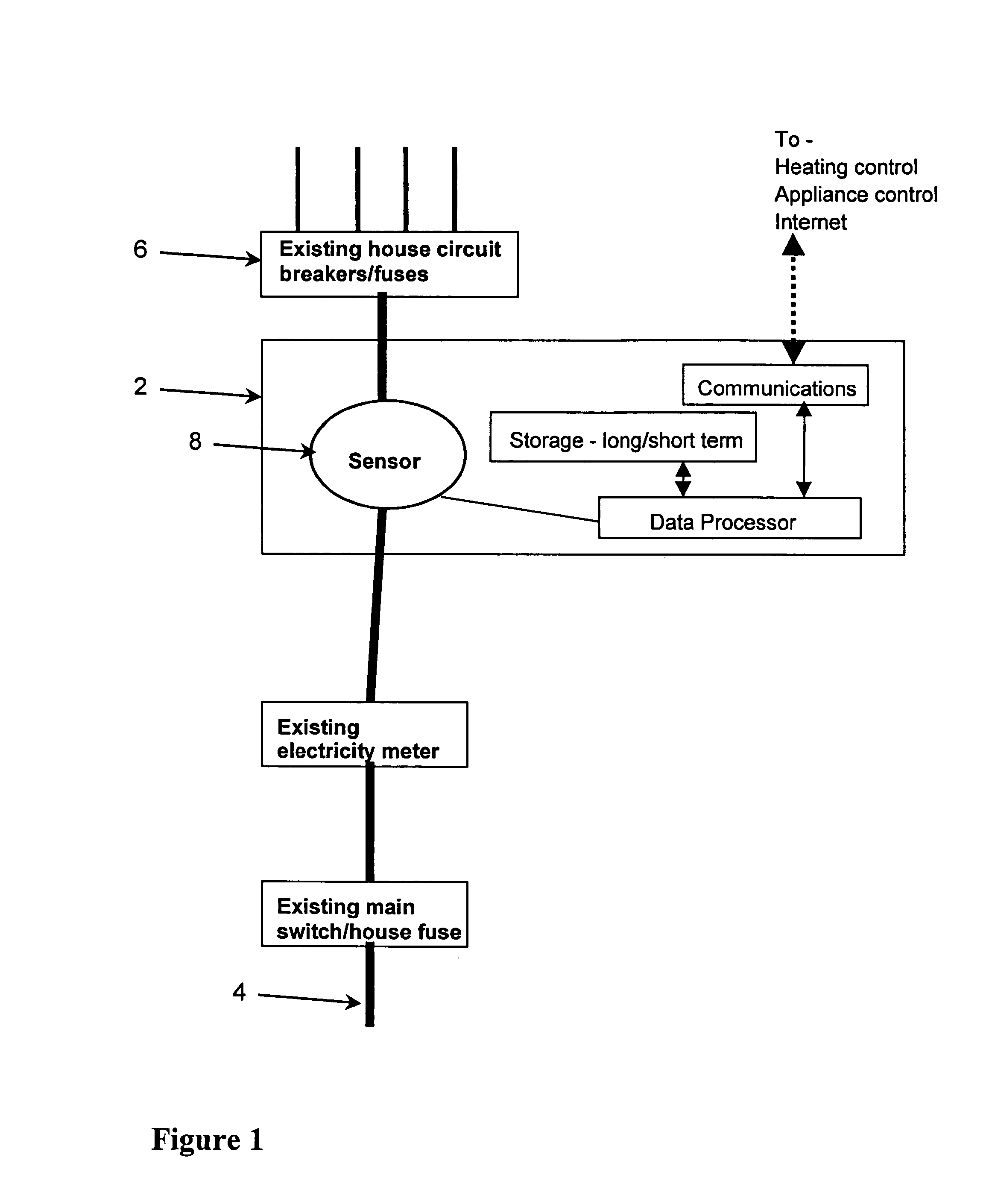

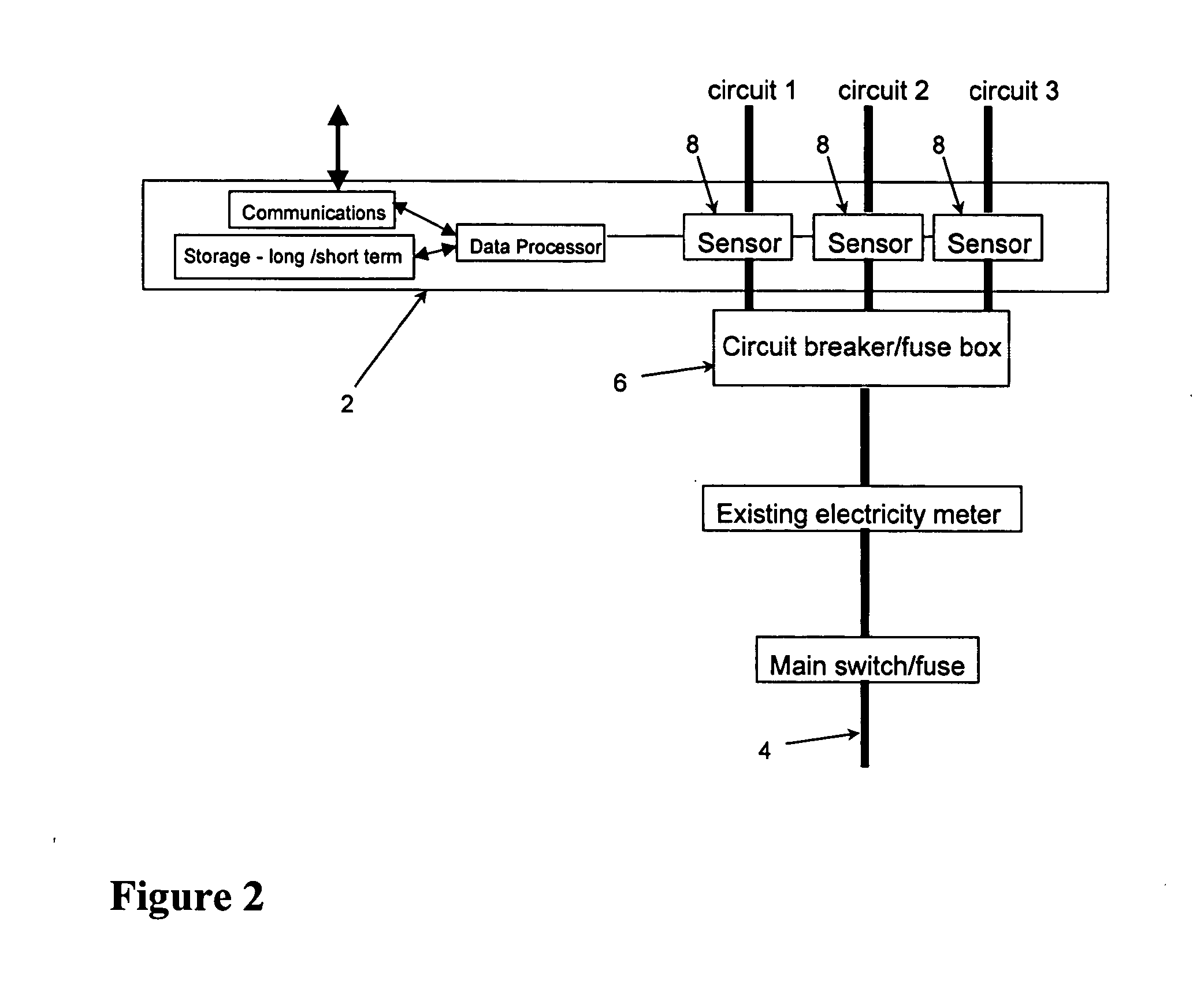

A household energy management system uses measurements of the household electricity supply 4 to identify and to determine the energy consumption of individual household appliances. From these measurements, models can be built of the behaviour of the occupants of the house, the thermal properties of the house and the efficiency of the appliances. Using the models, the household appliances—in particular heating and cooling appliances—can be controlled to optimize energy efficiency; and maintenance programmes for the appliances and for the house itself can be recommended to the householder or arranged with a service company.

Owner:CENTRICA HIVE LTD

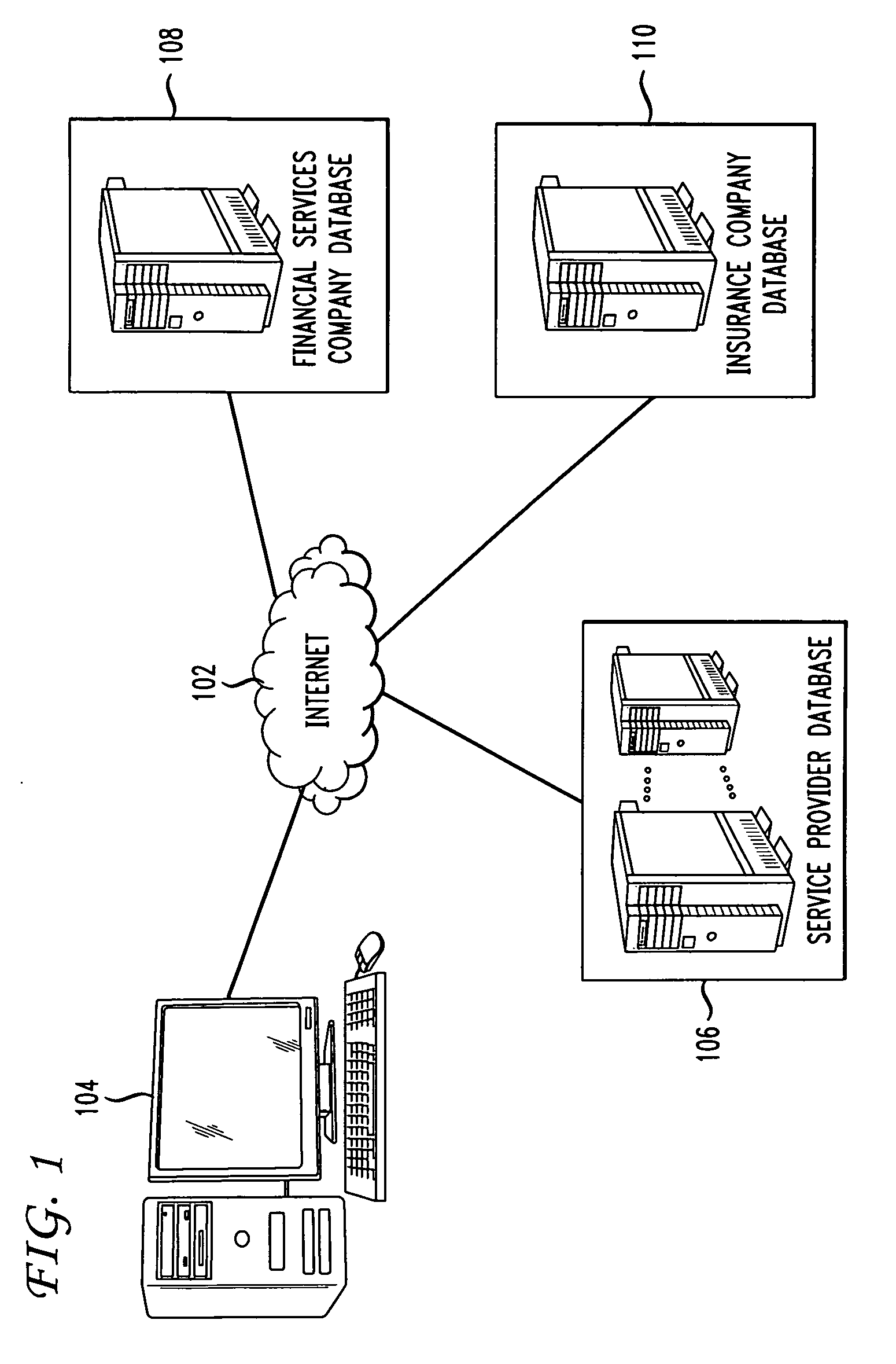

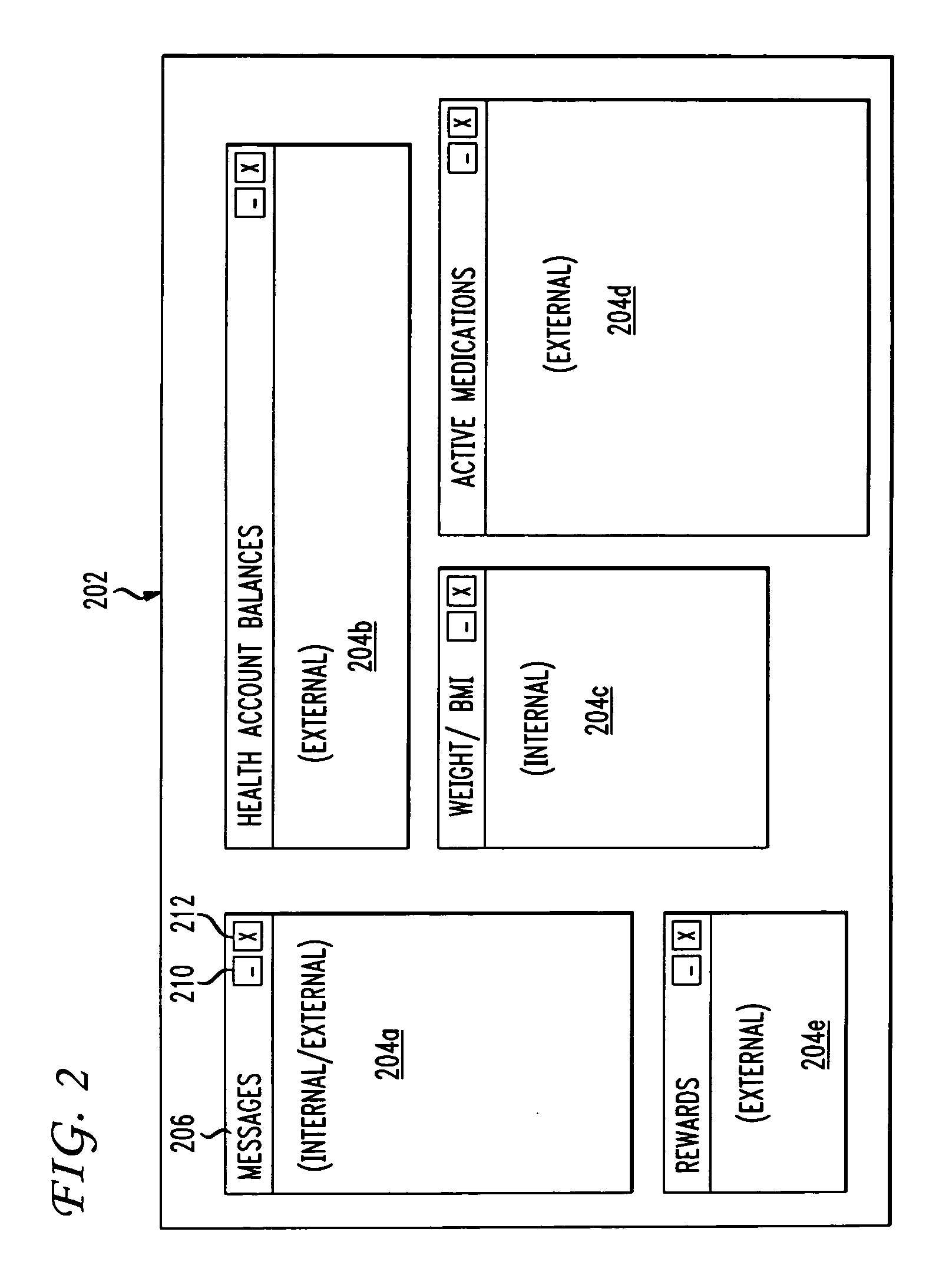

Interactive user interface for accessing health and financial data

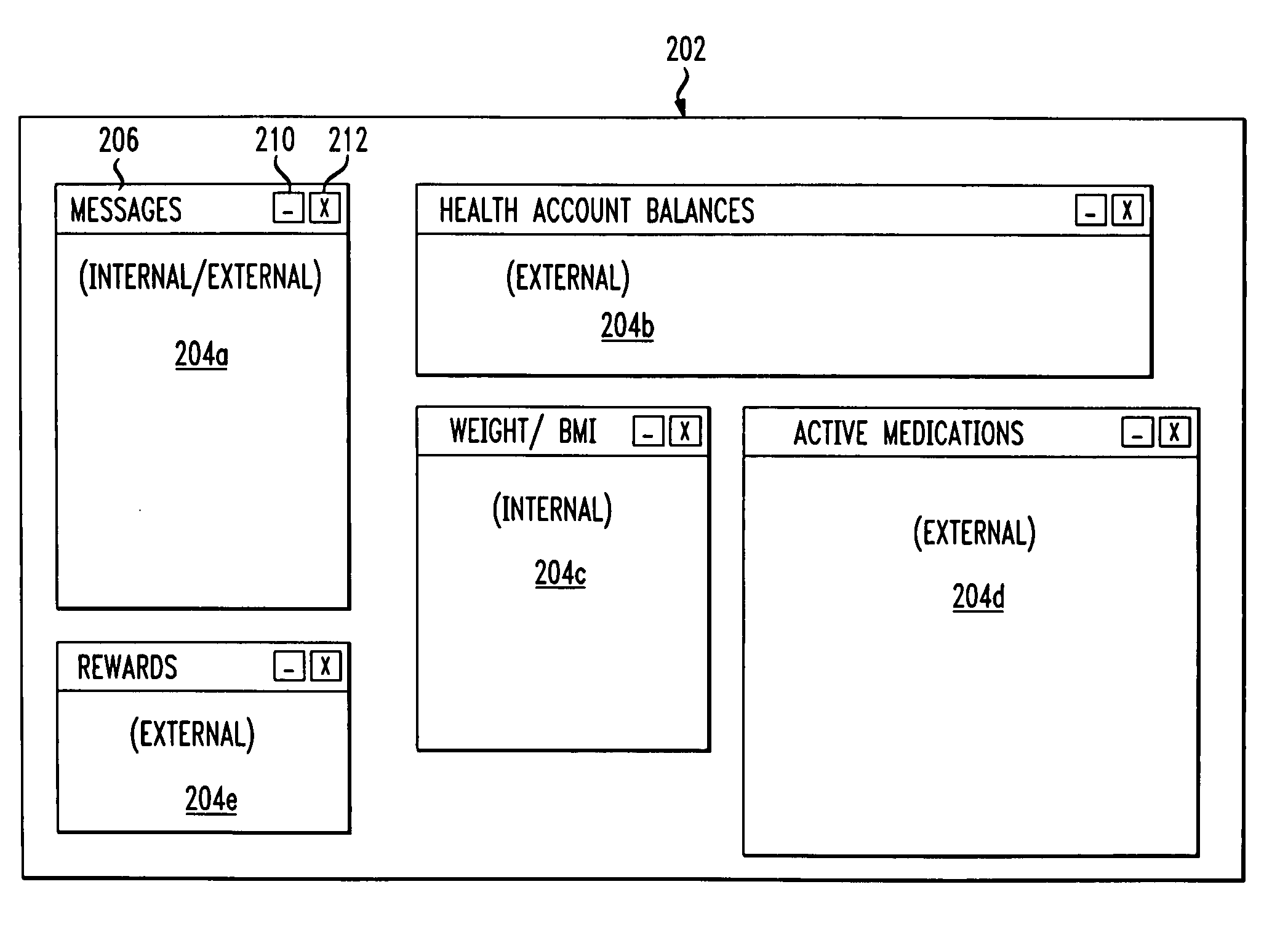

A user interface that integrates and uniformly presents to a healthcare consumer all or most of the consumer's health, health-related, and financial data is described. The interactive user interface is comprised of multiple dashboards which all have a generally uniform appearance and contain one category of health or financial data. A user can configure the size of each dashboard and its placement on the screen. By doing so, a healthcare consumer can view in one screen display data from multiple sources all relating to healthcare. The user interface is presented to a user by a service provider as the interface or window into a healthcare data management system provided by the service provider. The service provider itself stores and manages some of the consumer's health data, such as biometric readings. A dashboard of the present invention can contain data from the service provider or can contain data from an external source, such as an insurance company, a hospital, or a financial services company. In both cases the data are presented in the dashboards in a uniform manner. A consumer can open or “click on” the data in a dashboard and get further detail on the data. In the case of an external source or Web site providing the data, the consumer is taken to the site. The consumer only authenticates herself once when signing on to the service provider's system to view the user interface and dashboards. The consumer does not have to re-authenticate or sign on again when going to an external site via a dashboard.

Owner:IMETRIKUS

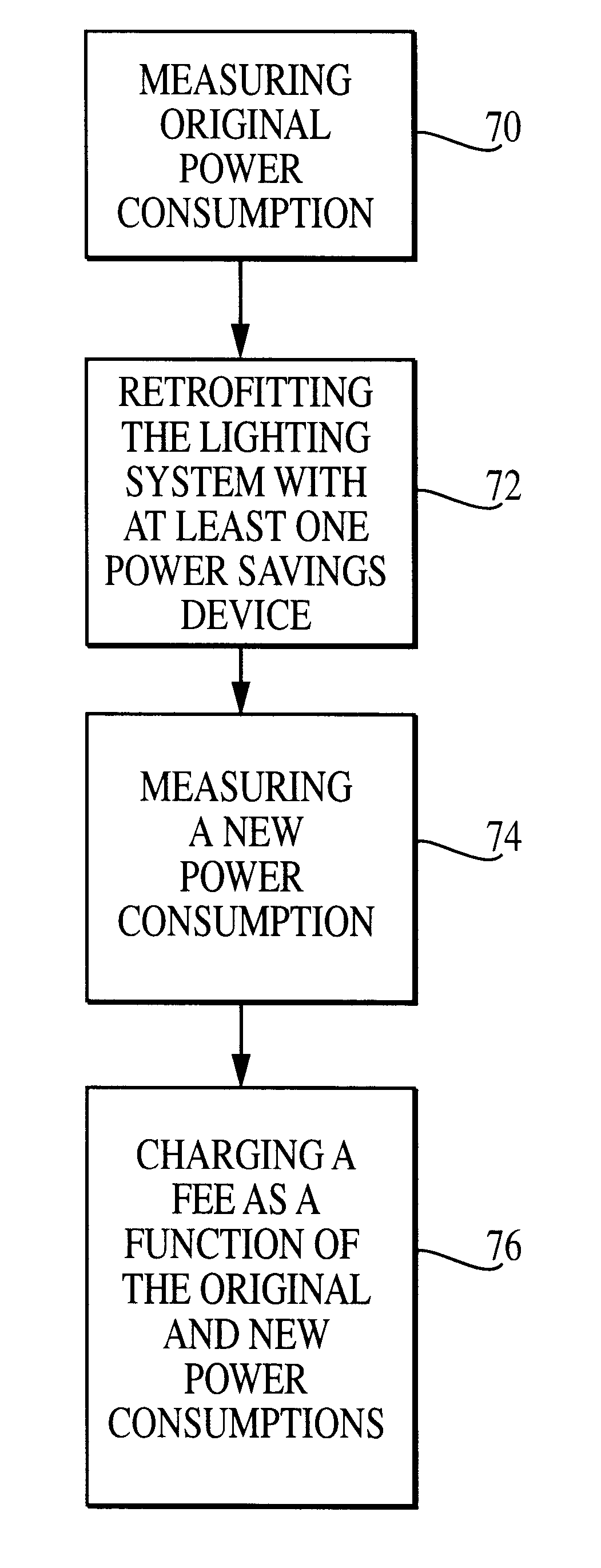

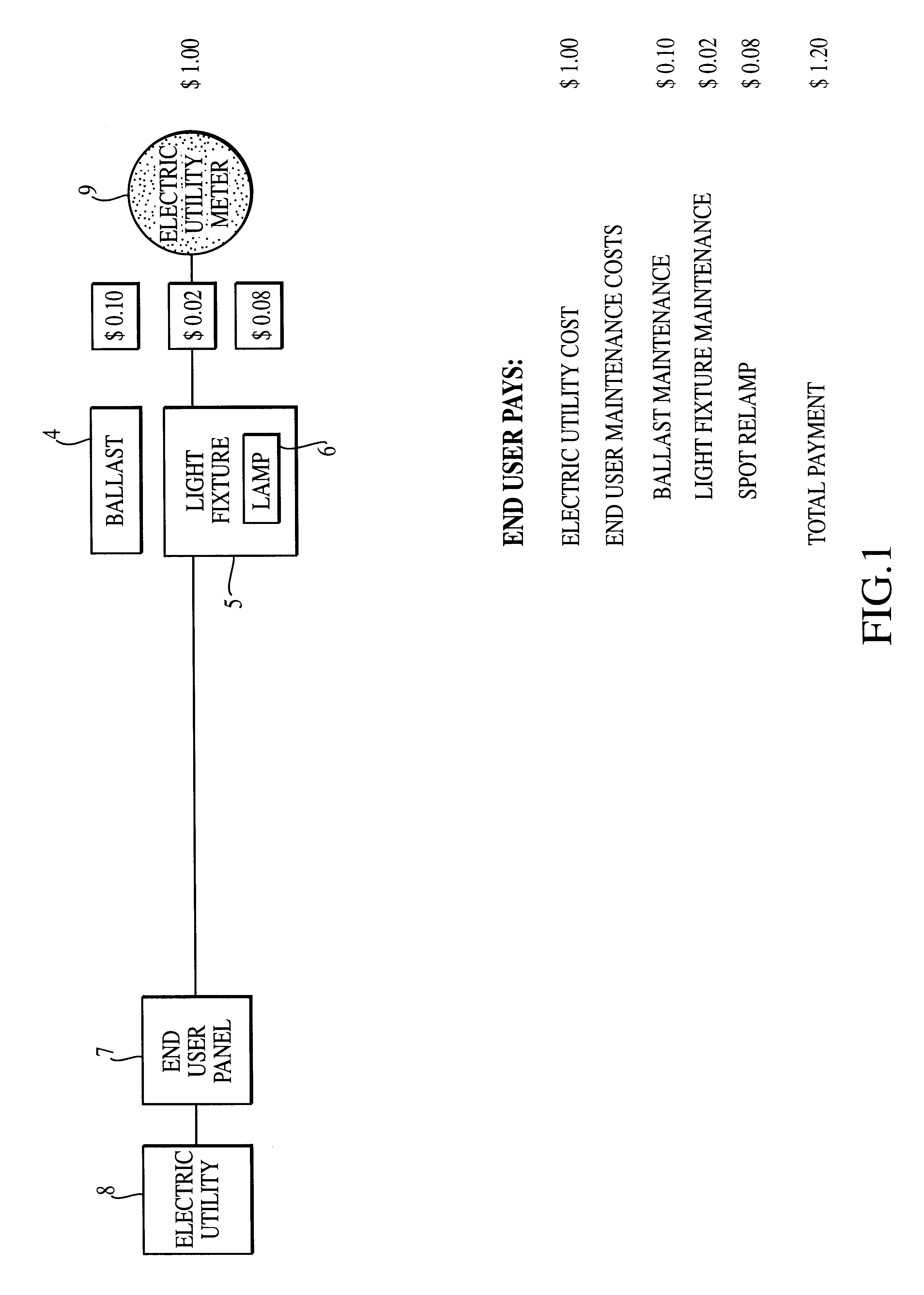

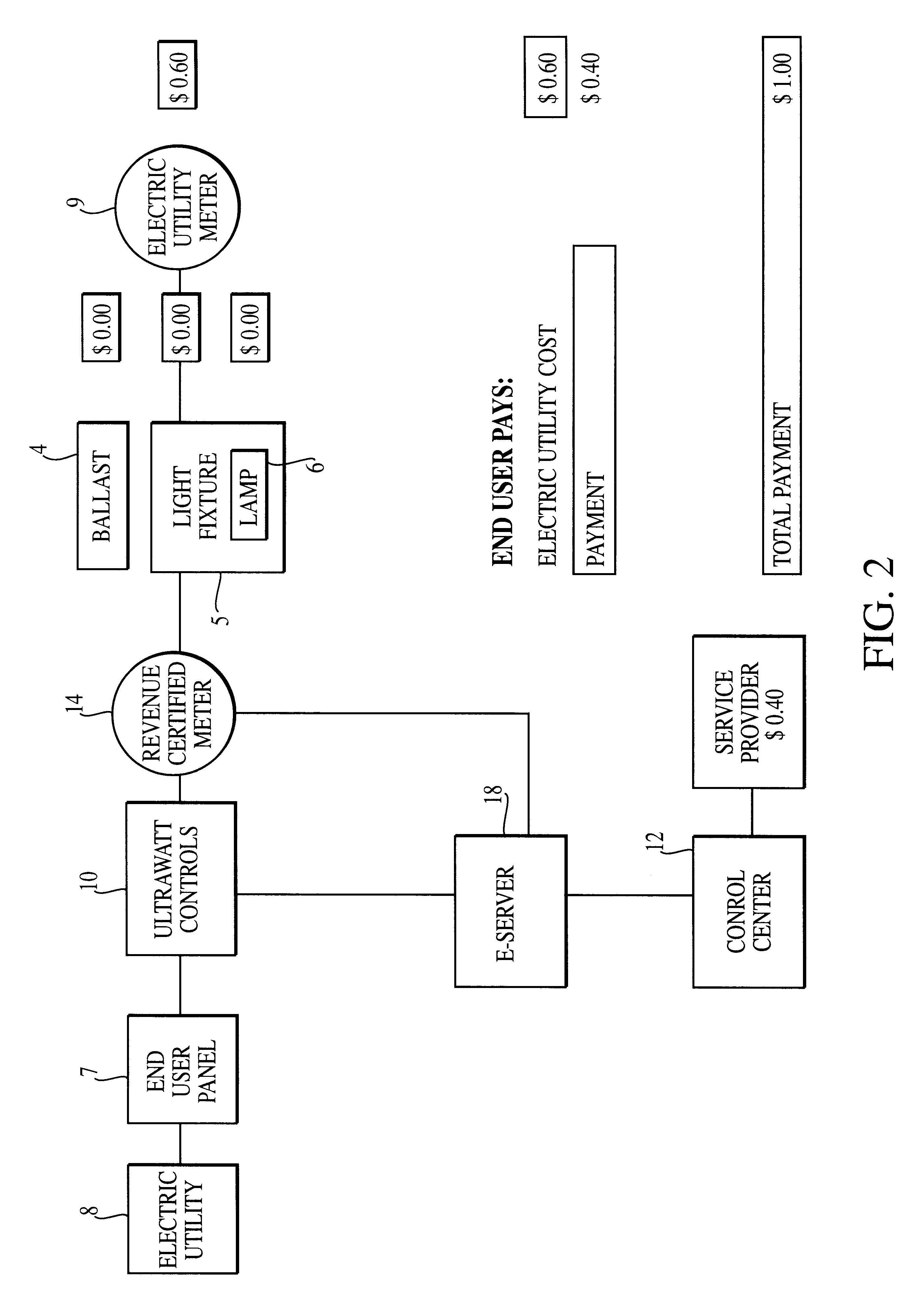

System and method for monitoring lighting systems

A method and system for charging a fee to an end user where a service company services a lighting system of the end user's facility. To determine the fee, an original power consumption of the facility is determined before the lighting system is retrofitted with at least one power savings device. Thereafter, the lighting system is retro-fitted with the at least one power saving device. Then, a new power consumption is measured of the facility. Finally, the fee is charged to the end user, such that the fee is a function of a difference between the original power consumption and the new power consumption.

Owner:LTI INT

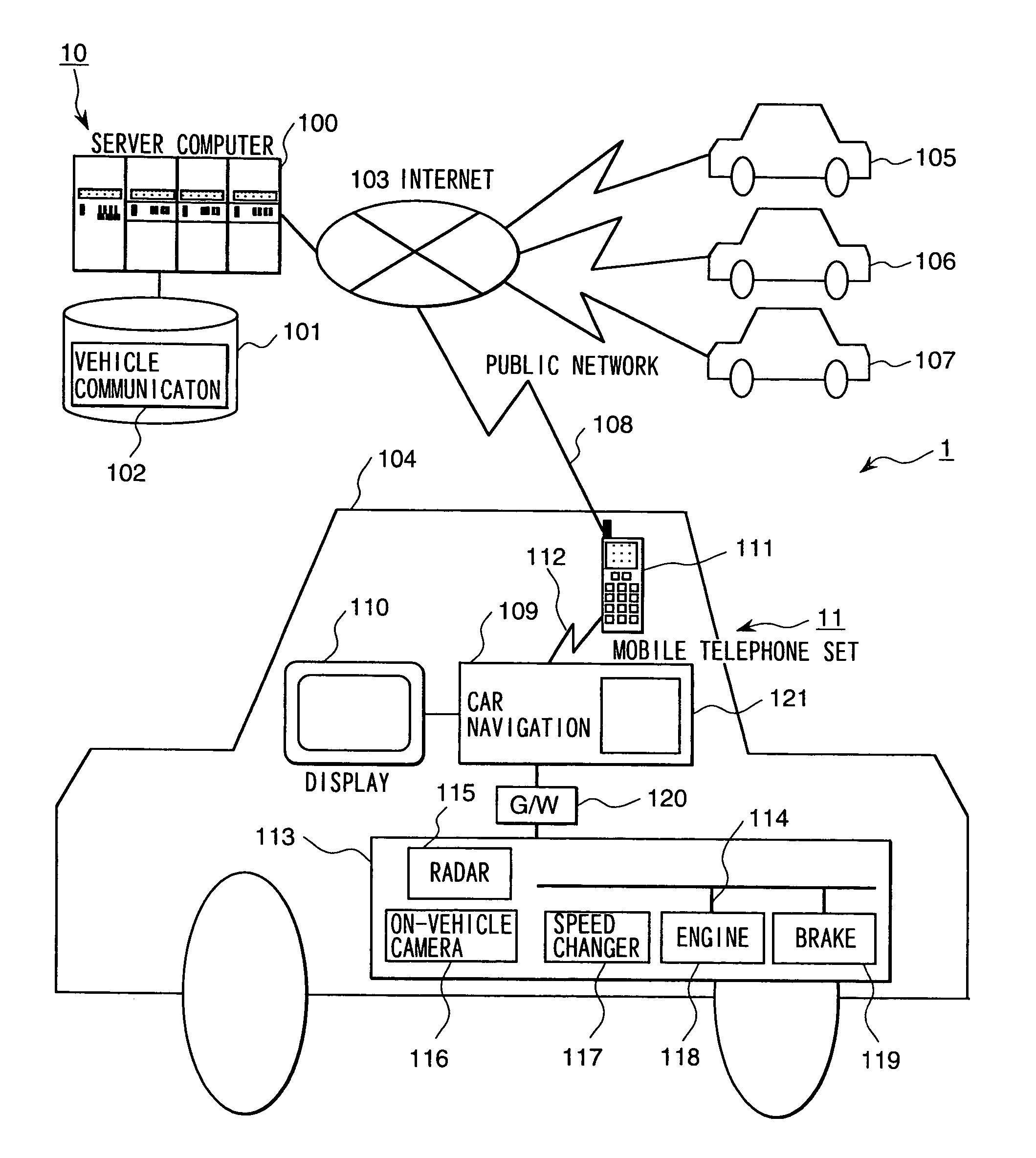

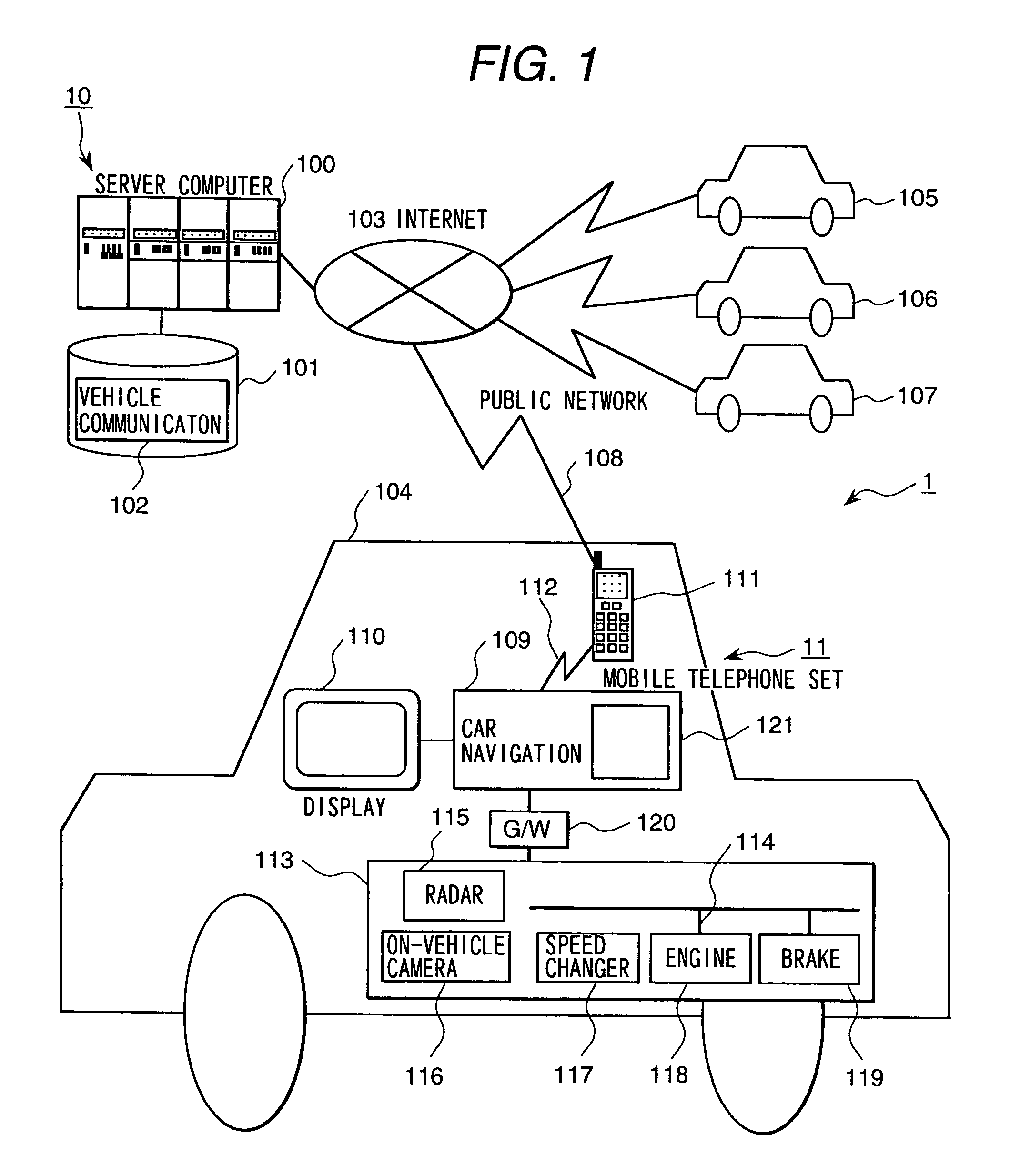

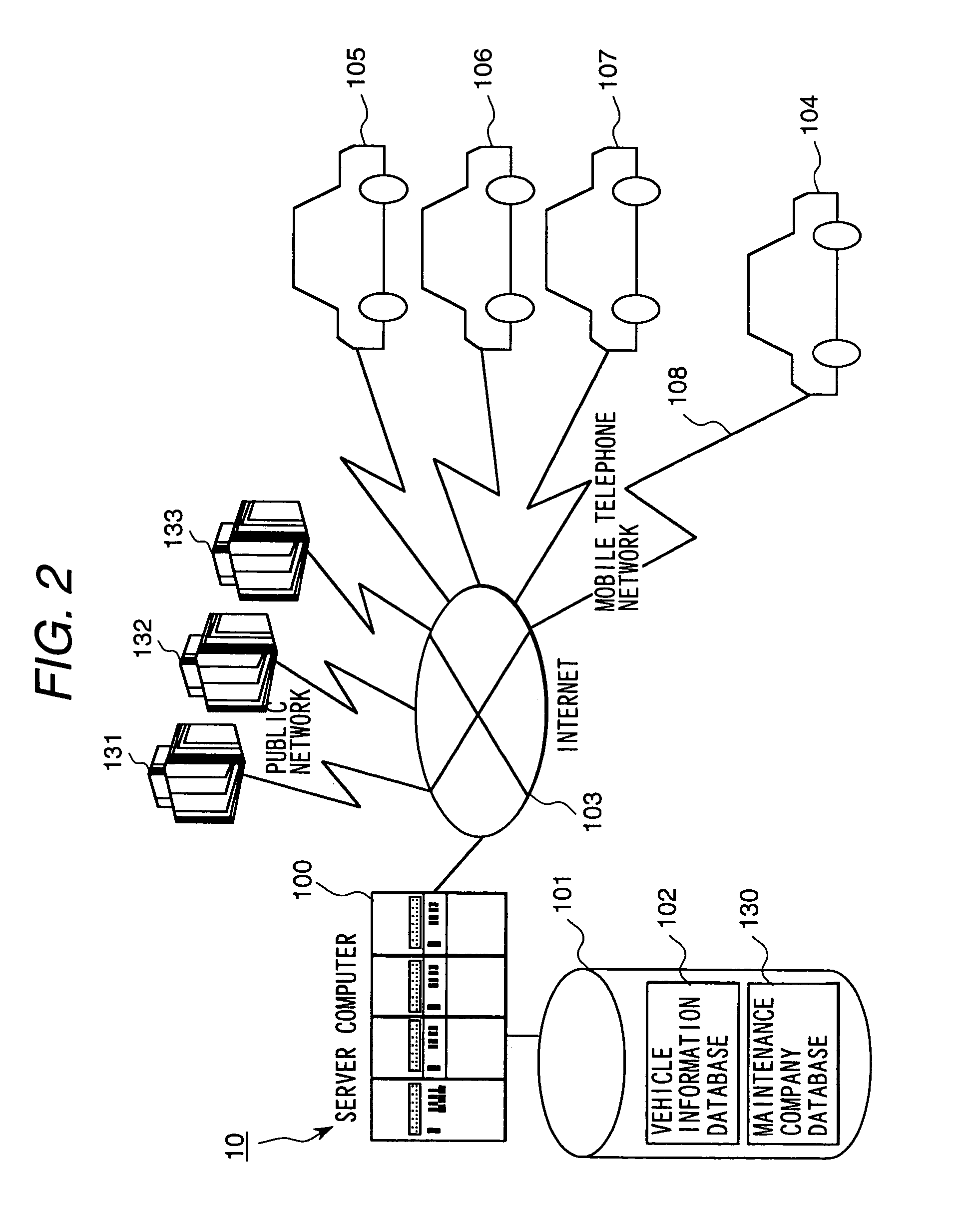

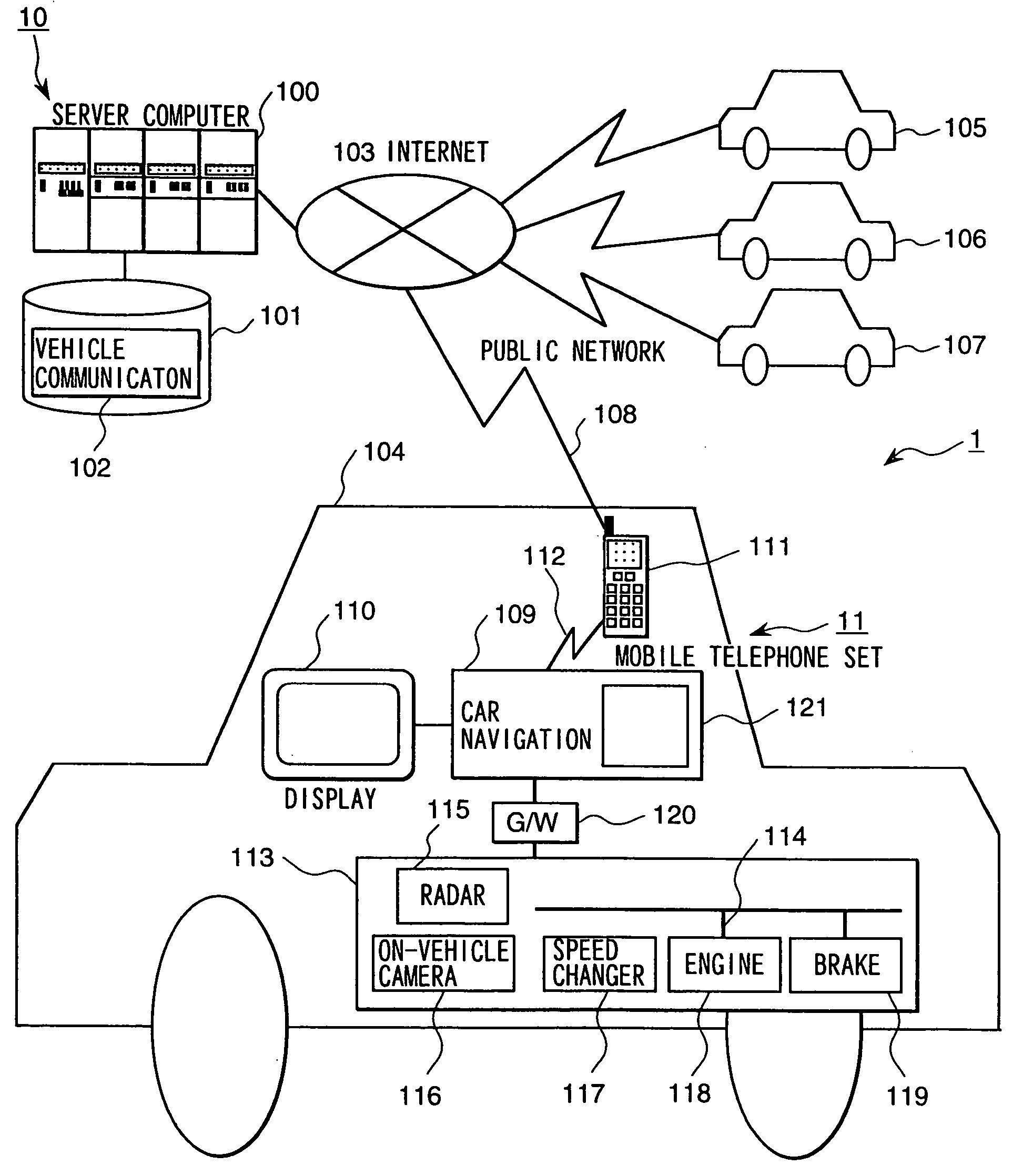

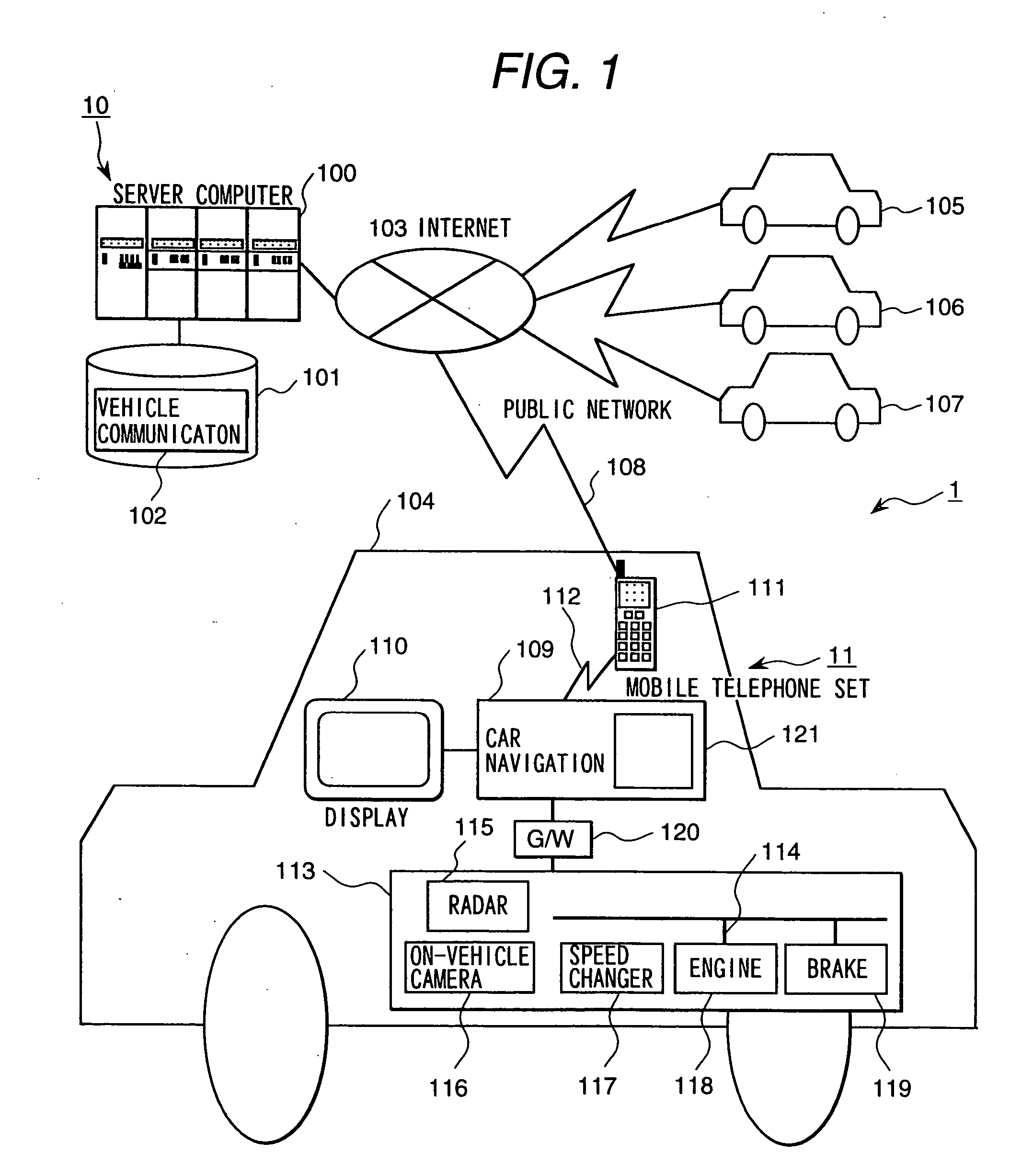

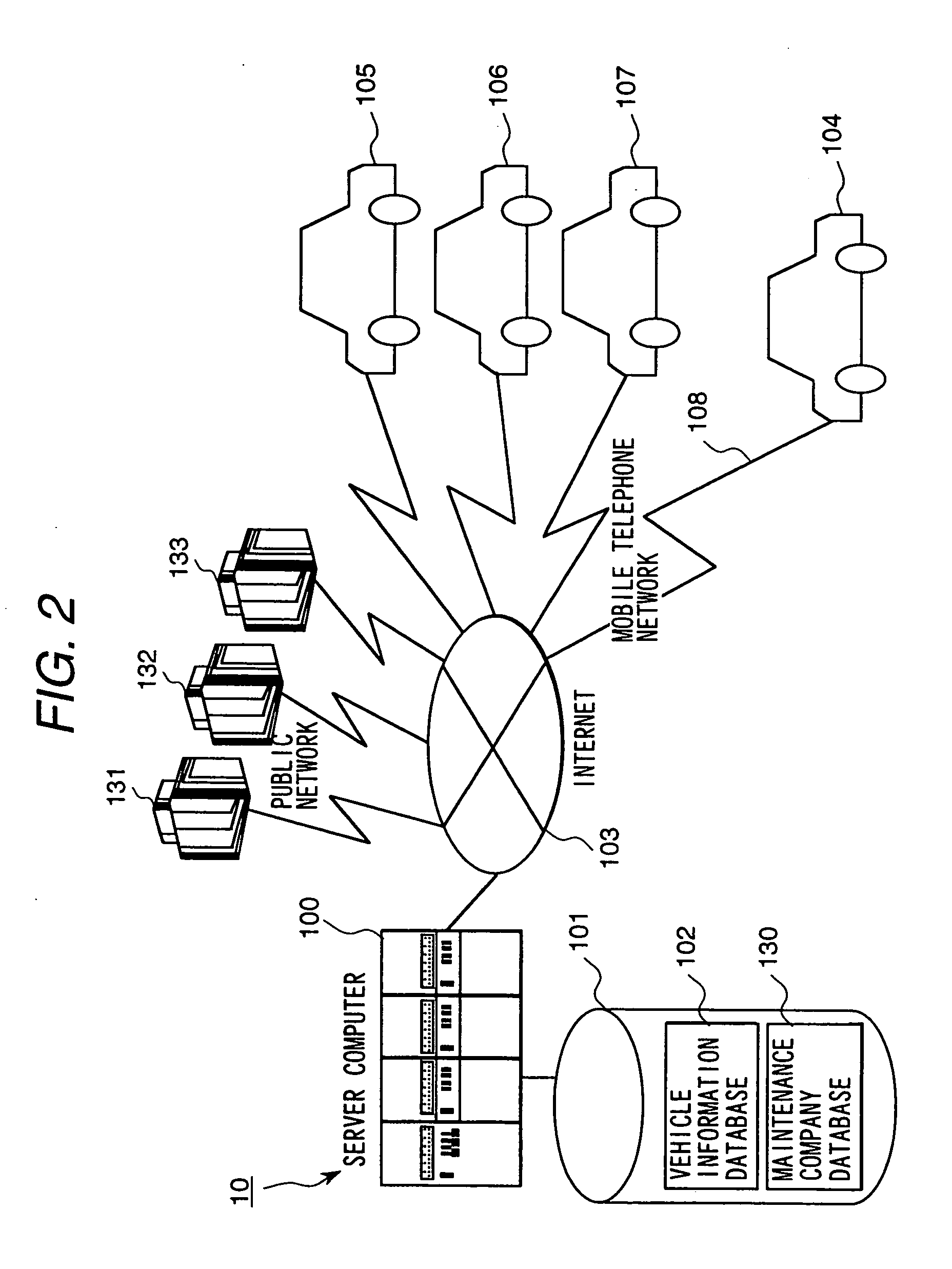

On-vehicle breakdown-warning report system

InactiveUS6972669B2Easy selectionShorten the timeVehicle testingRegistering/indicating working of vehiclesDrivetrainCommunication device

An on-vehicle breakdown-warning report system is disclosed. an occurrence of break-down is detected and judged based on a signal in an electronic control system installed on a control apparatus for an engine ignition system, a charging system, an engine fuel system, a engine cooling system, a power transmission system, and an oil lubricating system of an automobile or a diagnosis display system; and a diagnostic data is sent to an information terminal device of a diagnosis and maintenance agency or a service company having a diagnosis and maintenance agency as a contents information by using an on-vehicle mobile communication apparatus, and an action for an emergency measures and a maintenance schedule is asked.

Owner:HITACHI LTD

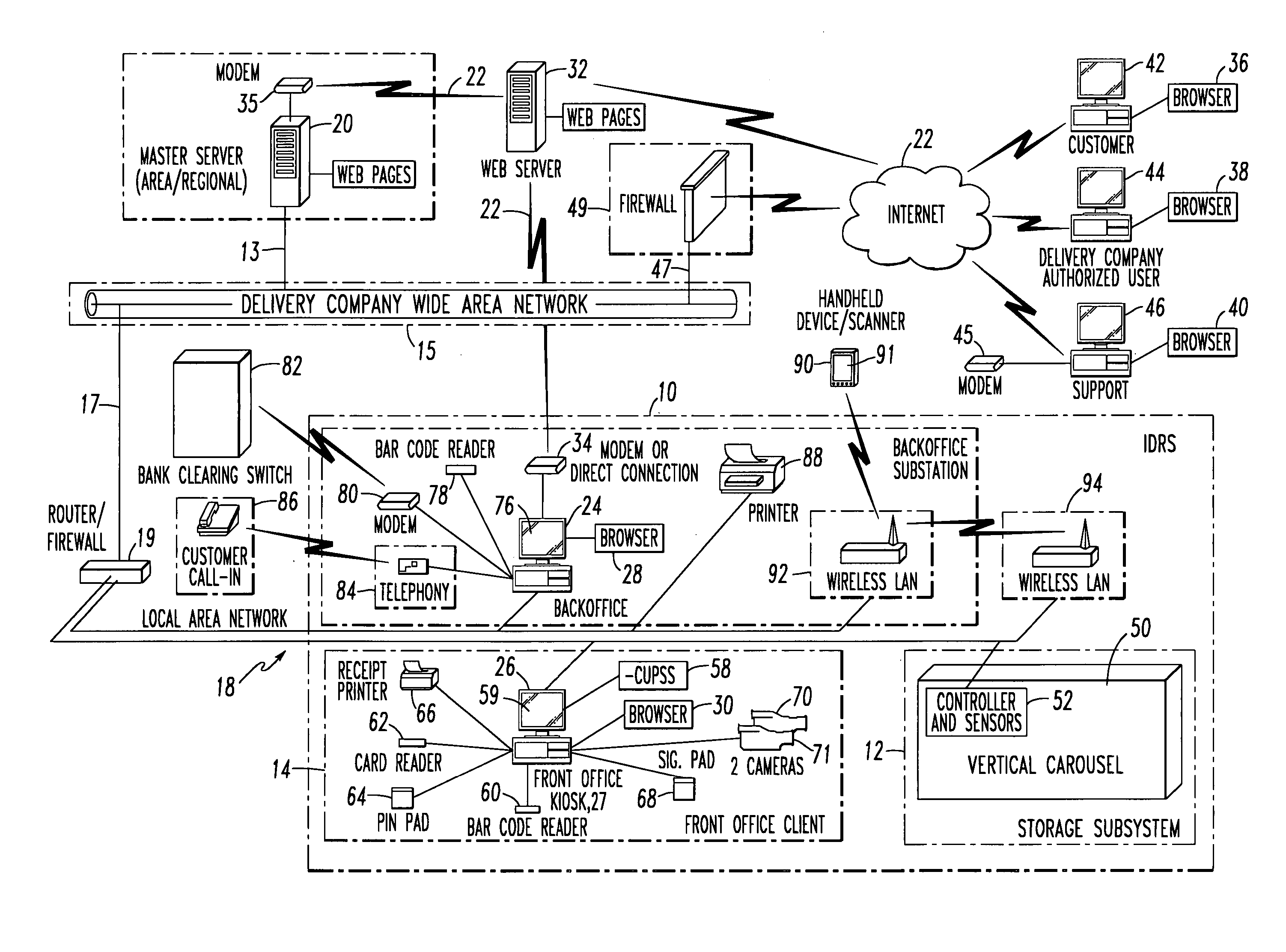

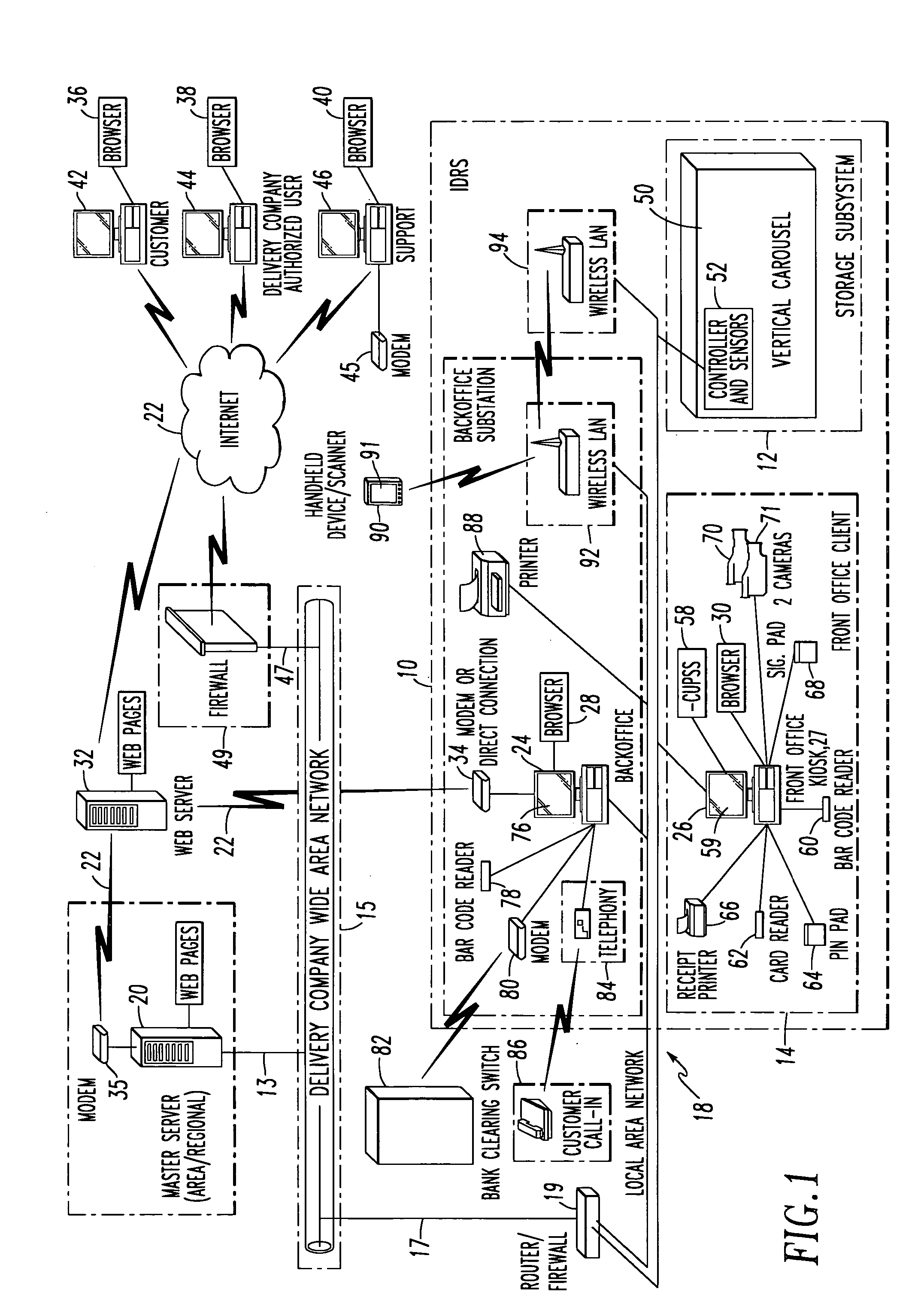

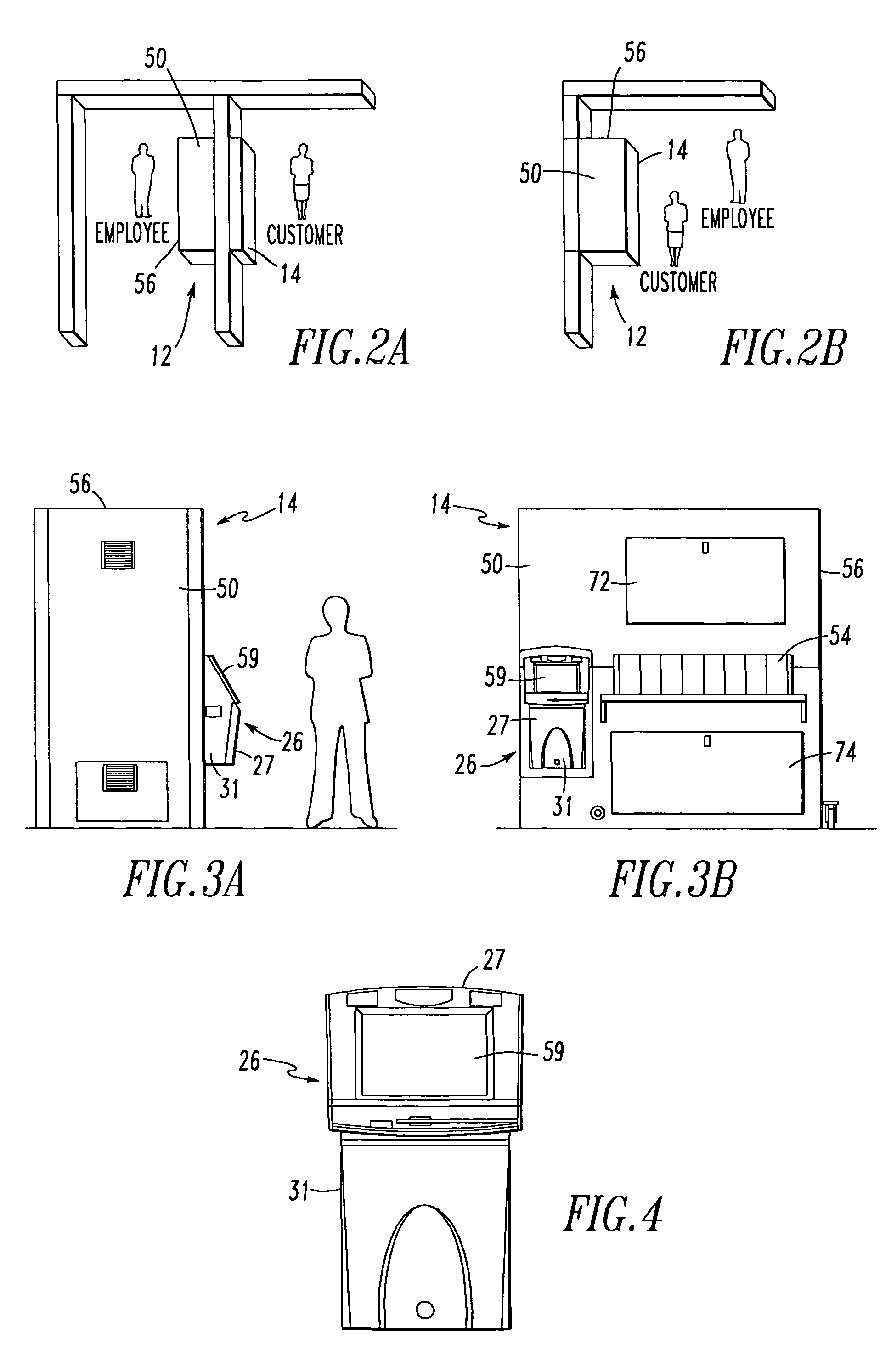

Item delivery and retrieval system

InactiveUS7133743B2Easy and user friendly accessAcutation objectsApparatus for meter-controlled dispensingThe InternetApplication software

An item delivery and retrieval system including a storage subsystem and a computer subsystem. The storage subsystem includes a secure enclosure having an item storage carousel including internal controller apparatus. The computer subsystem is embodied in internet web page based customized application software for implementing an application interface of selectively configurable ActiveX controls for providing user access, such as an employee of a delivery service company and / or a customer of the delivery service company and customer access to one or more storage bins located behind a set of normally closed doors, for providing access control to the bins, and for managing the location of the items in the storage subsystem. The doors are opened when proper identification is provided by the customer so as to permit retrieval of items located in specifically designated bin(s) or to return items thereto.

Owner:NORTHROP GRUMMAN SYST CORP

Using energy-use sensors to model activity and location of building users

A household energy management system uses measurements of the household electricity supply to identify and to determine the energy consumption of individual household appliances. From these measurements, models can be built of the behaviour of the occupants of the house, the thermal properties of the house and the efficiency of the appliances. Using the models, the household appliances—in particular heating and cooling appliances—can be controlled to optimize energy efficiency; and maintenance programmes for the appliances and for the house itself can be recommended to the householder or arranged with a service company.

Owner:CENTRICA HIVE LTD

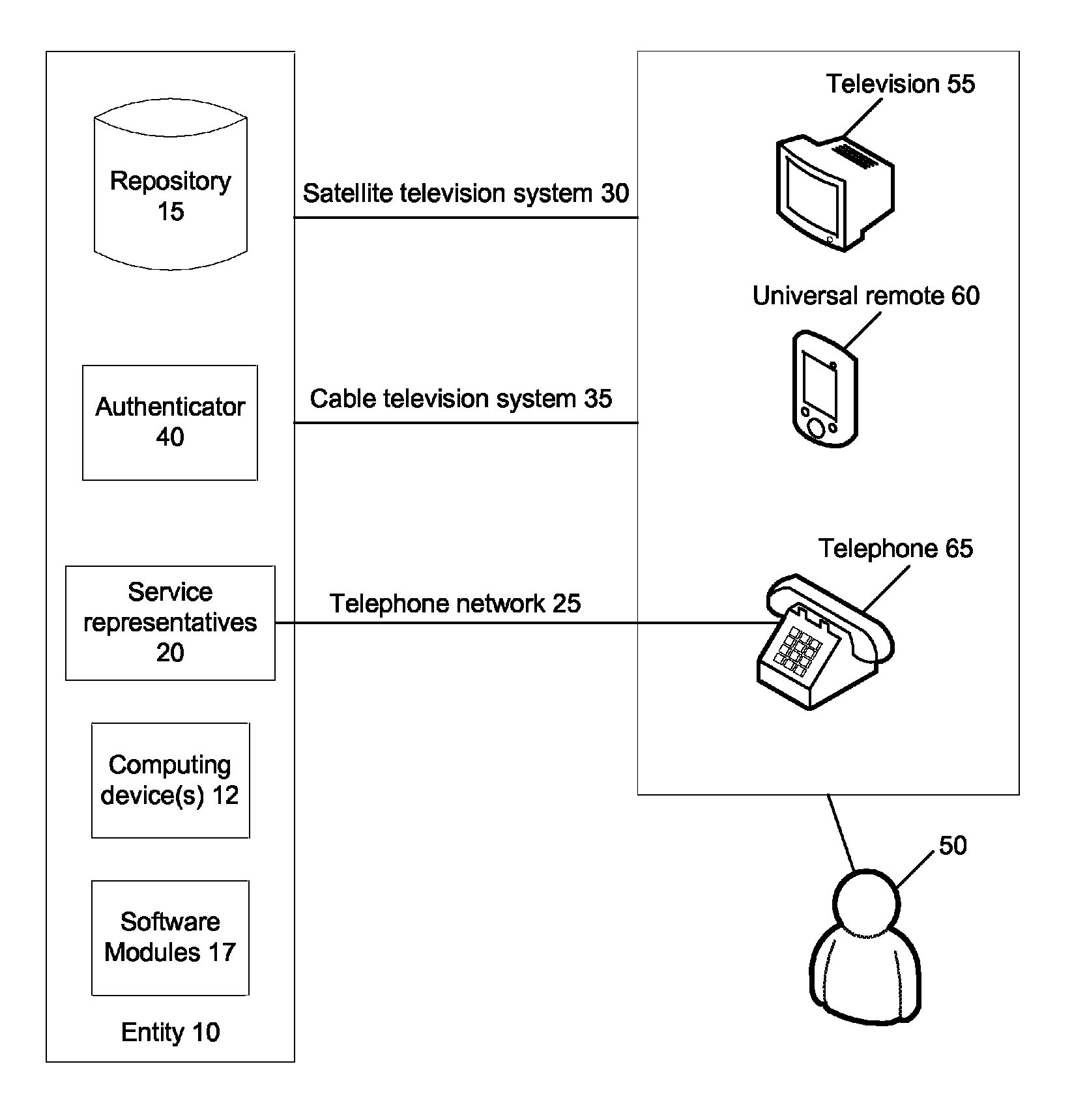

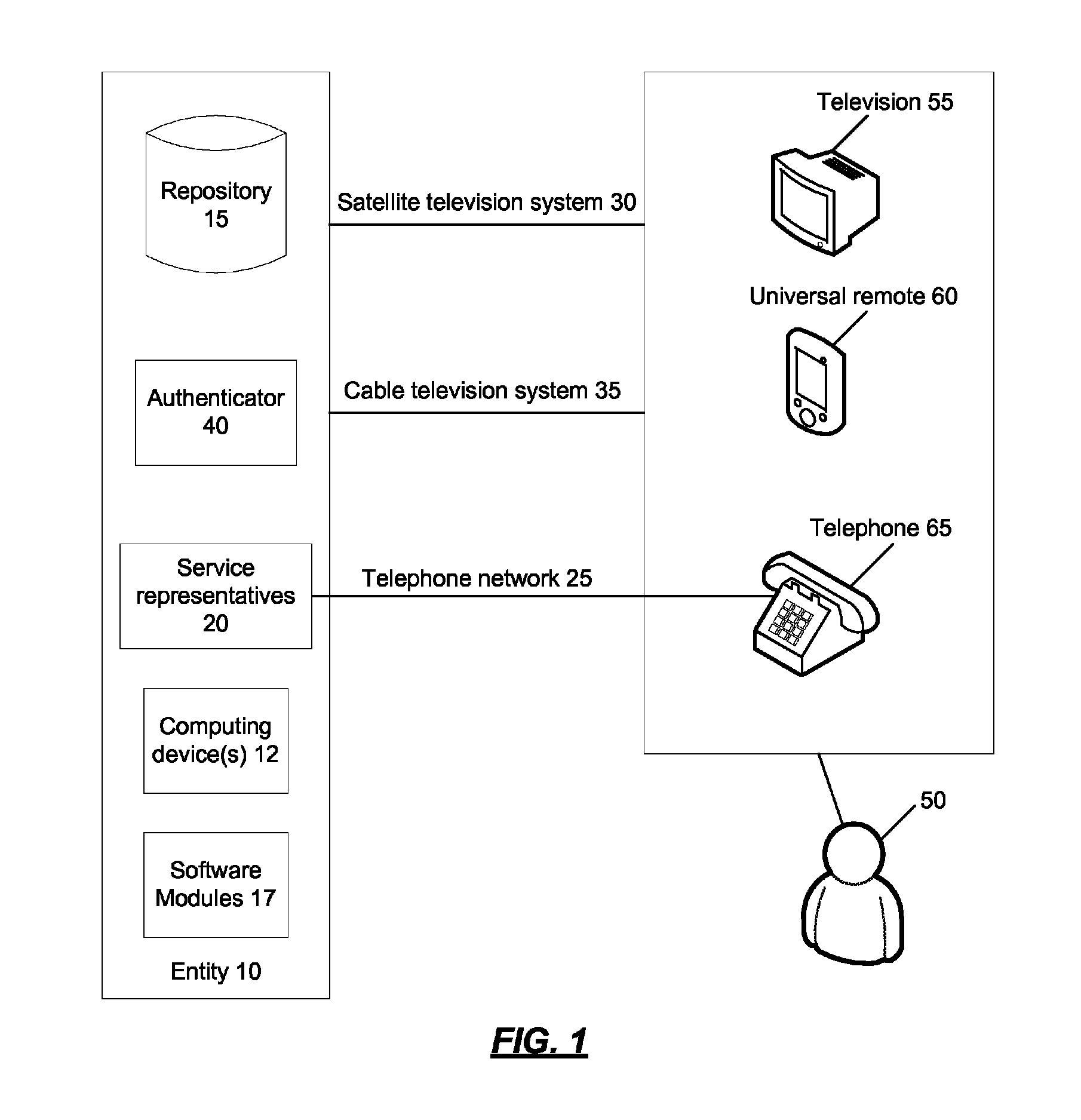

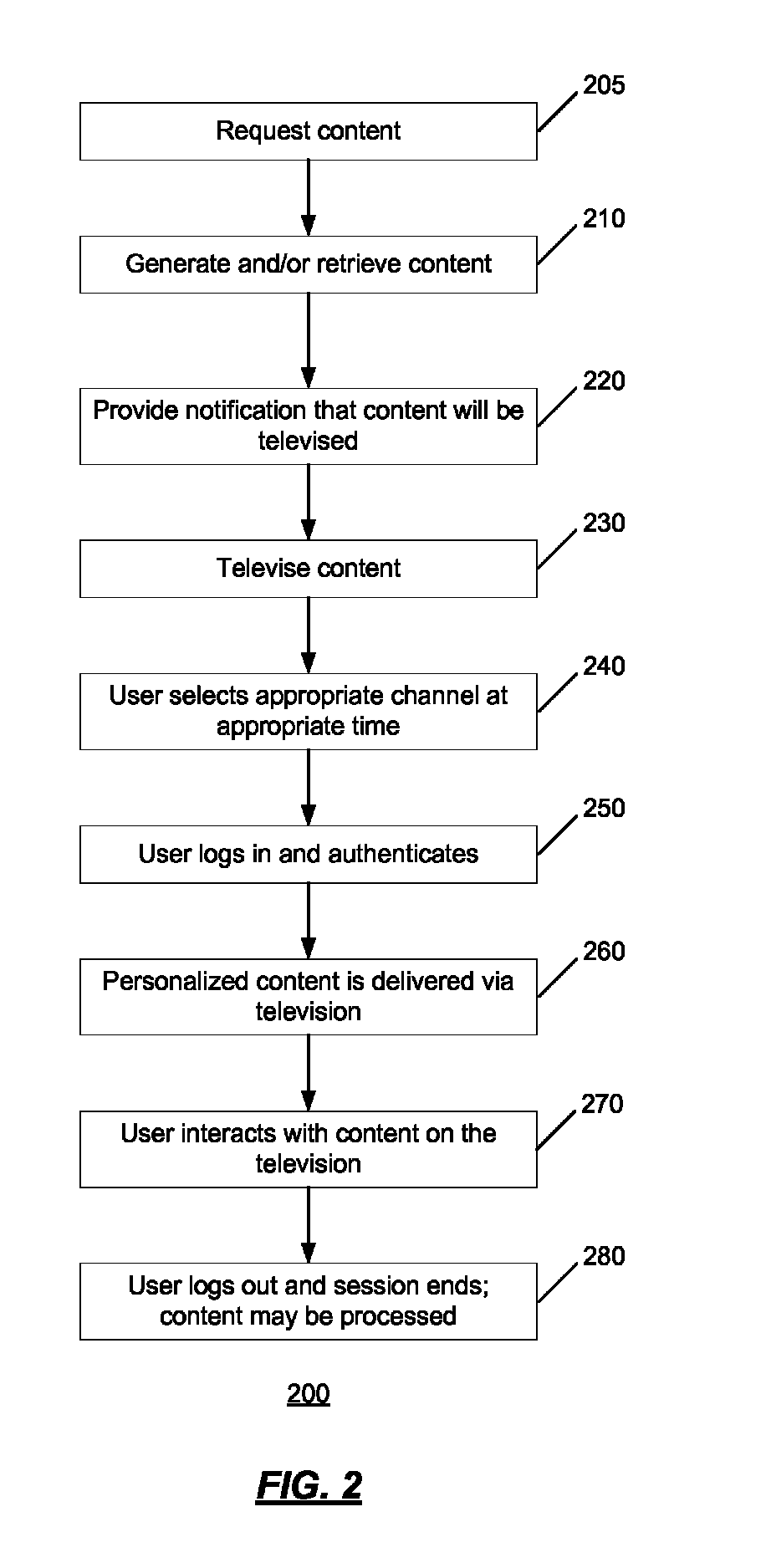

Systems and methods for providing self-services over television

Cable and satellite television systems, televisions, and universal remotes are used to provide interactive financial self-services to users. The cable or satellite system provides a connection between a user and a financial services company. A television or other display device connects to the cable or satellite system and displays content from the financial services company to a user. The user may enter data and navigate through the content via a back channel using a universal remote or other input device. The user may thus complete the content, such as completing a loan application, opening a bank account, or purchasing insurance. The user may provide authentication information to receive personalized content.

Owner:USAA

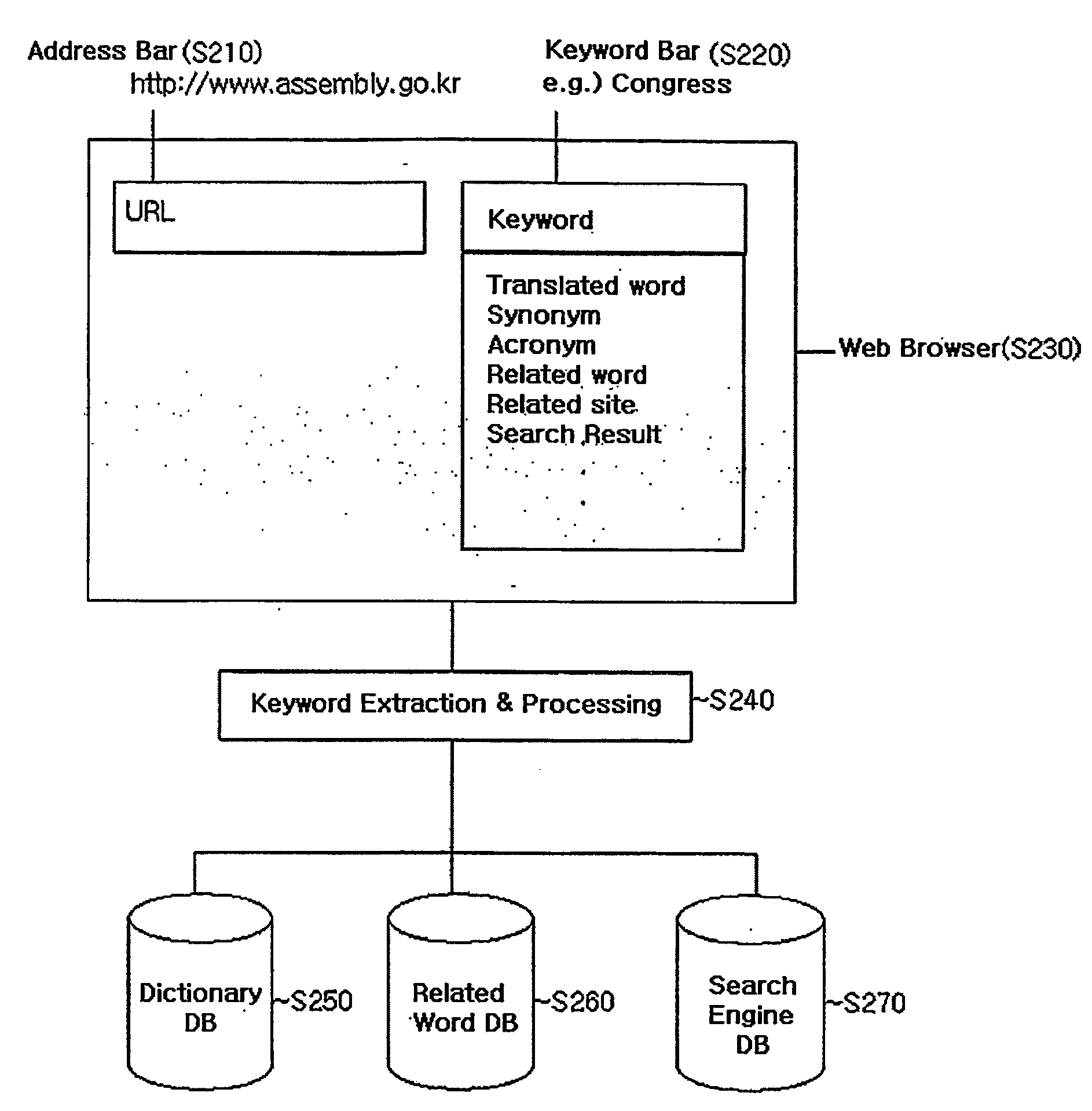

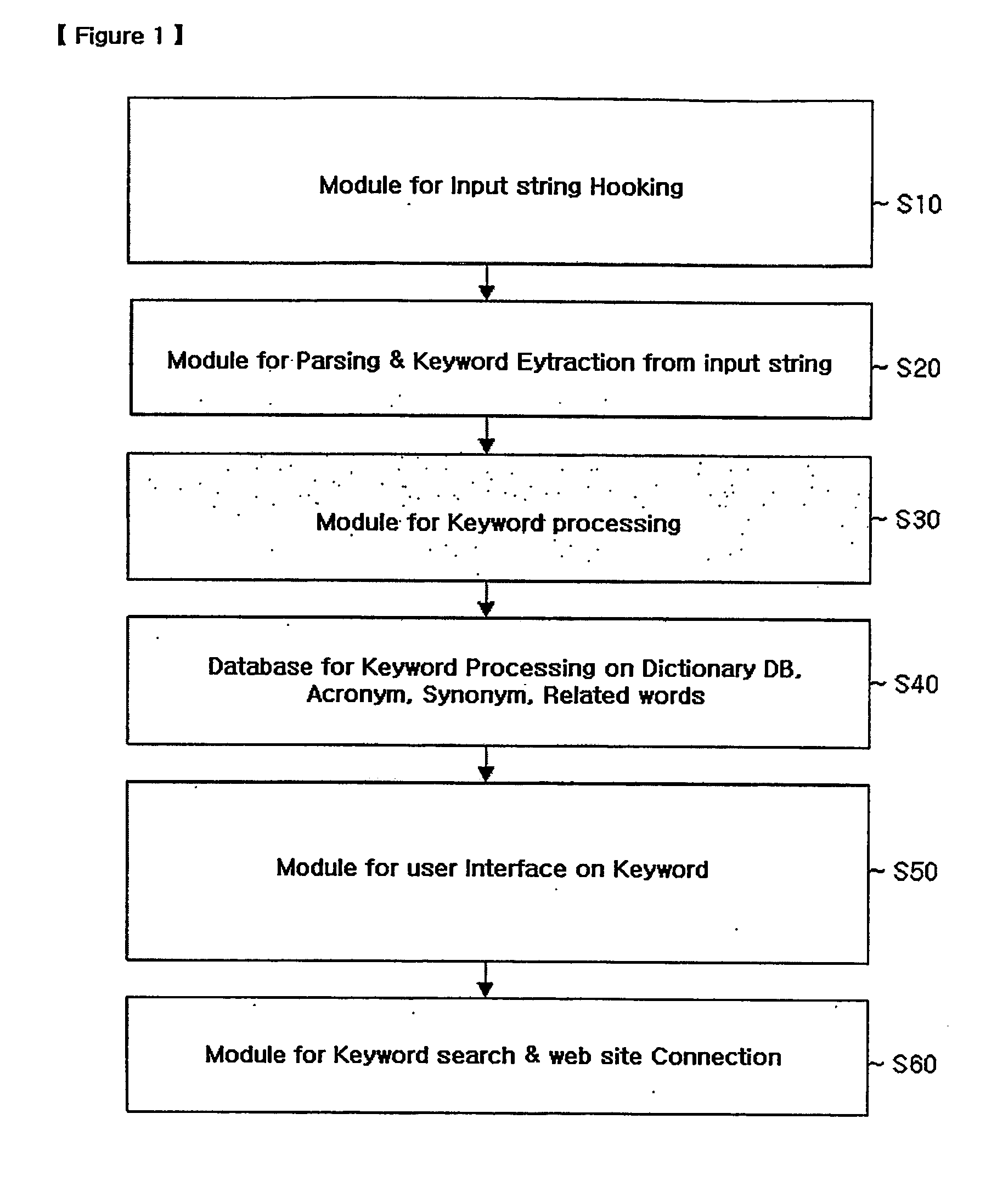

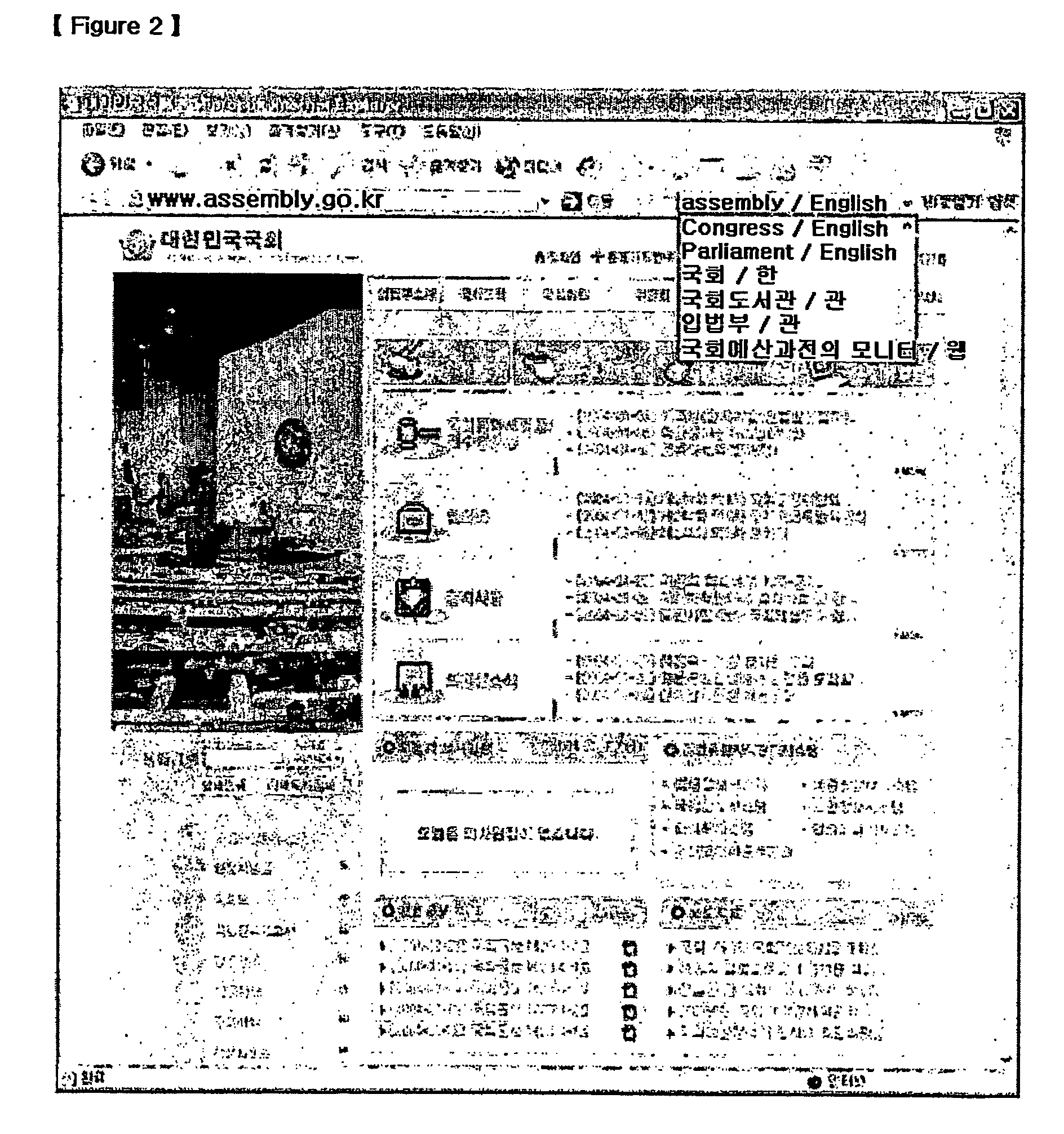

Dynamic Keyword Processing System and Method For User Oriented Internet Navigation

InactiveUS20080281816A1Reduce effortShorten the timeSpecial data processing applicationsWeb data retrieval using information identifiersDomain nameWeb site

A system and method are described that enable users to navigate on the web according to use's own keyword definition on web site, keyword extraction and processing from user's visiting website, user's selection on keyword categories, and mapping between E-mail address and URL. The user's own keyword definition on web site is user-driven keyword naming scheme is opposite) method of the keyword domain services which were service company-driven method. The user's selection on keyword categories provides users choice on keyword categories and group. The keyword extraction and processing from user's visiting web site provides keyword extraction from the page and arranges for related keywords in order to prepare for anticipated search and navigation from the user's current web site and keyword. The mapping system between E-mail and URL provides conversion of E-mail address into URL, in order to use as domain name.

Owner:METANAV CORP

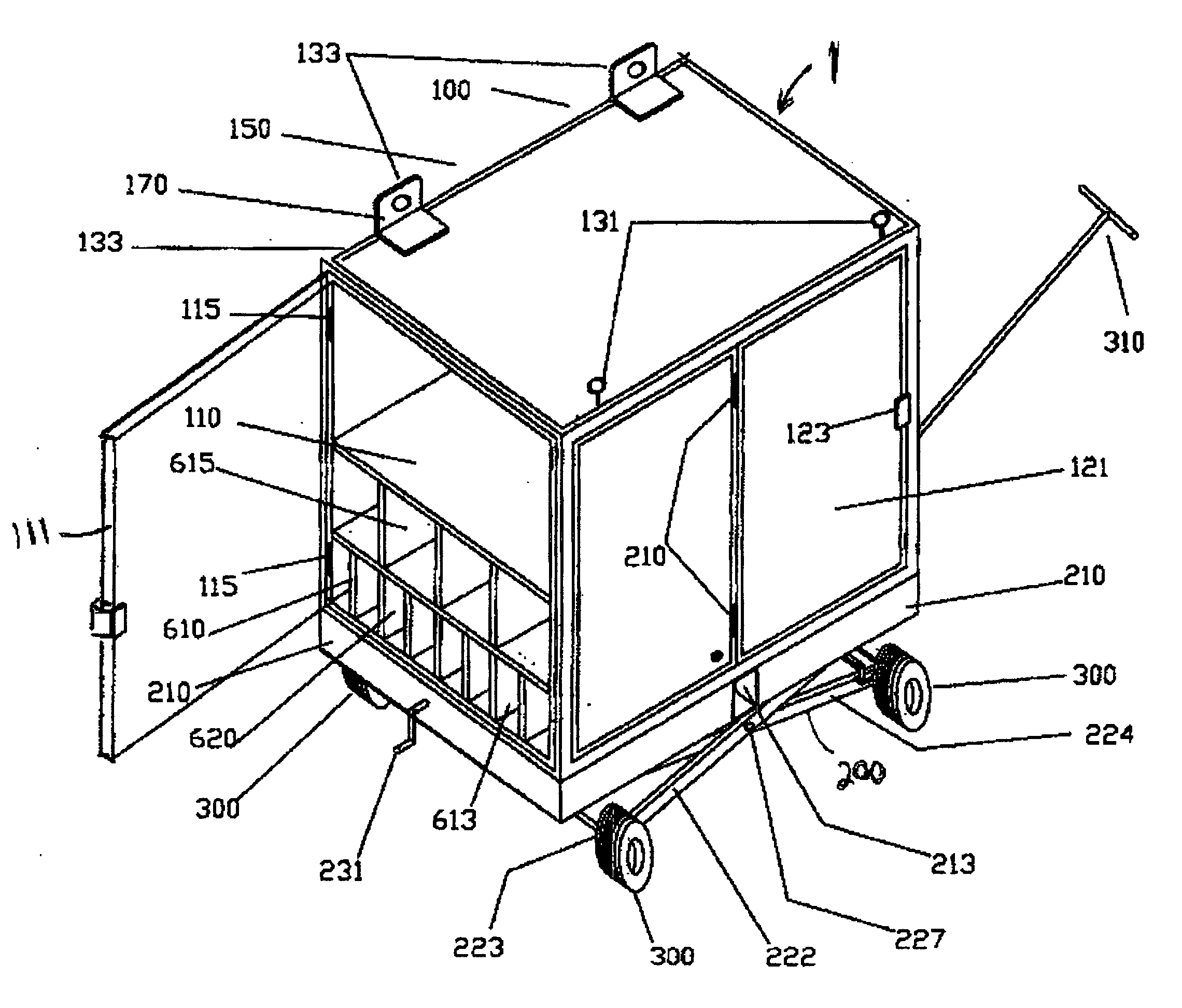

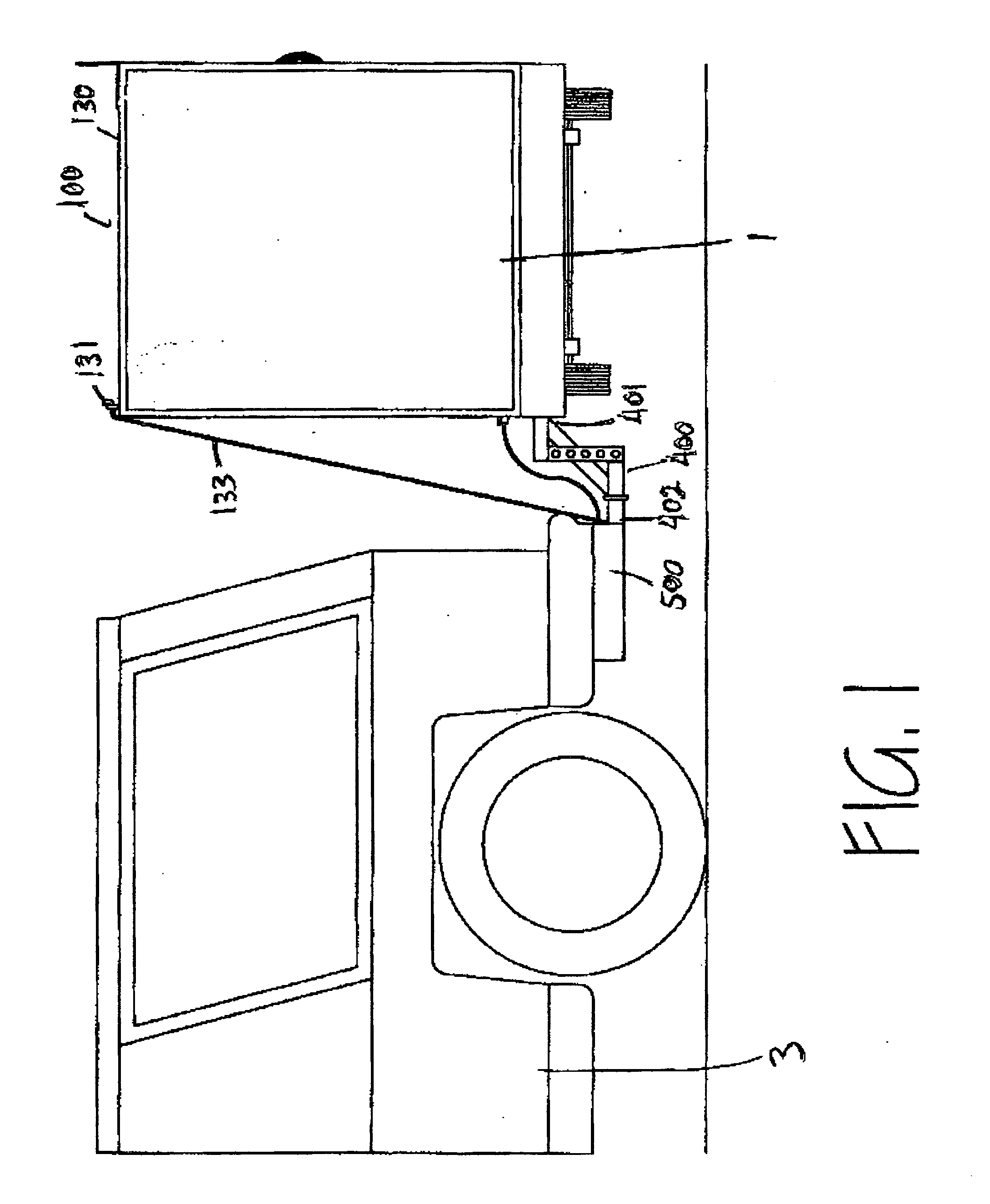

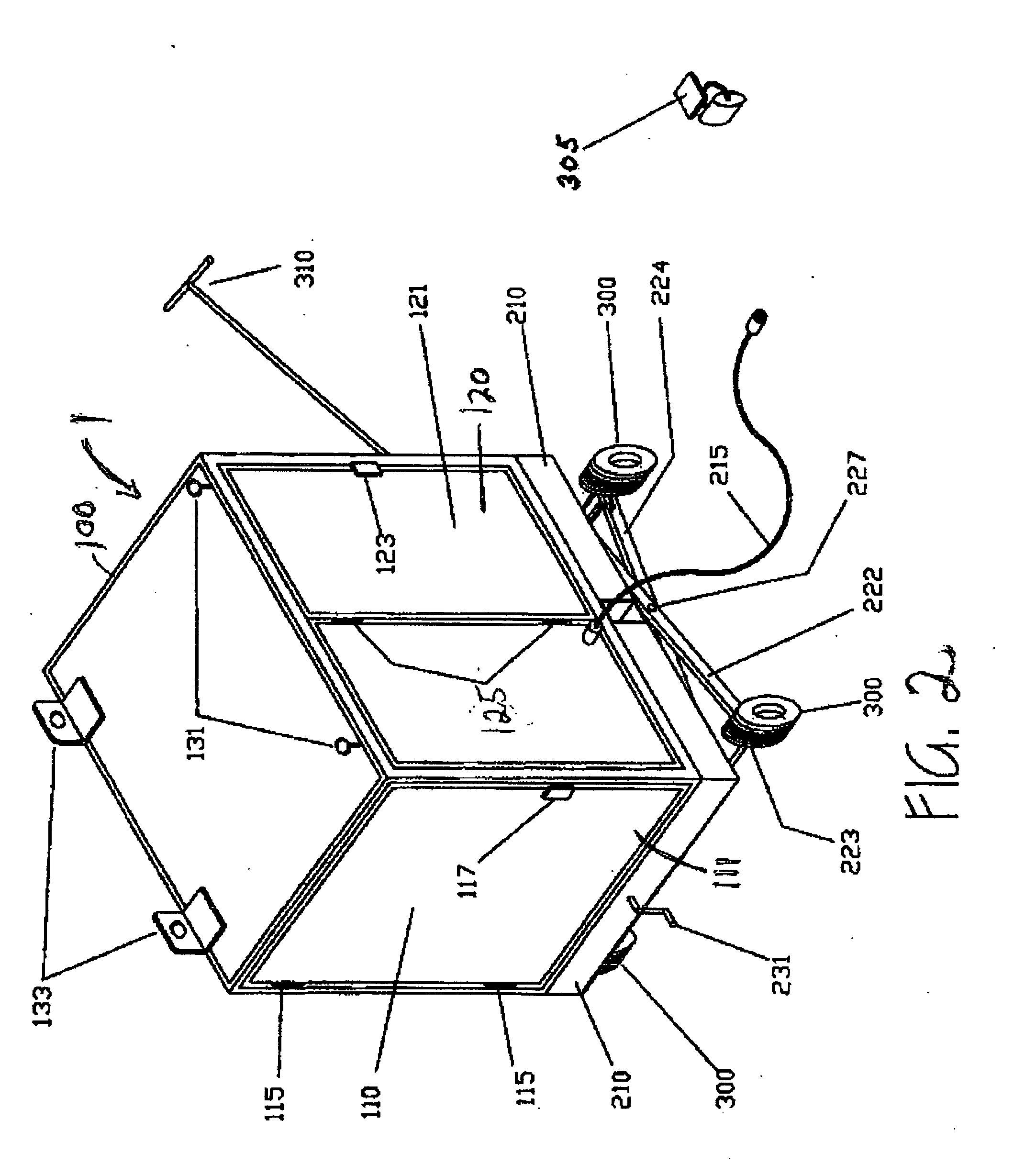

Mobile storage cart

InactiveUS20060228201A1Easily dismountedOther load carrying vehiclesTransportation itemsEngineeringSport training

A portable cart is described which has an extendable base to elevate the cart to a proper height to mount in the receiver or a trailer hitch. The extendable base is retracted, pulling up the cart wheels. This allows the cart to be carried by a vehicle. Once at the desired location, the vehicle is parked. The extendable base is extended to support the weight of the cart, which is removed from the vehicle. The cart may then be lowered and wheeled to its use site. The cart may be designed to hold baseball equipment, act as a sports training cart with first aid supplies, or material spill cleanup equipment. It may also carry food and supplies for catering, contain an outdoor mobile grill, act as a service company cart, a construction cart, an equipment cart for first responders, a pet show cart, a trade show cart or employ armored to carry ammunition and military supplies.

Owner:LENCESKI BENJAMIN

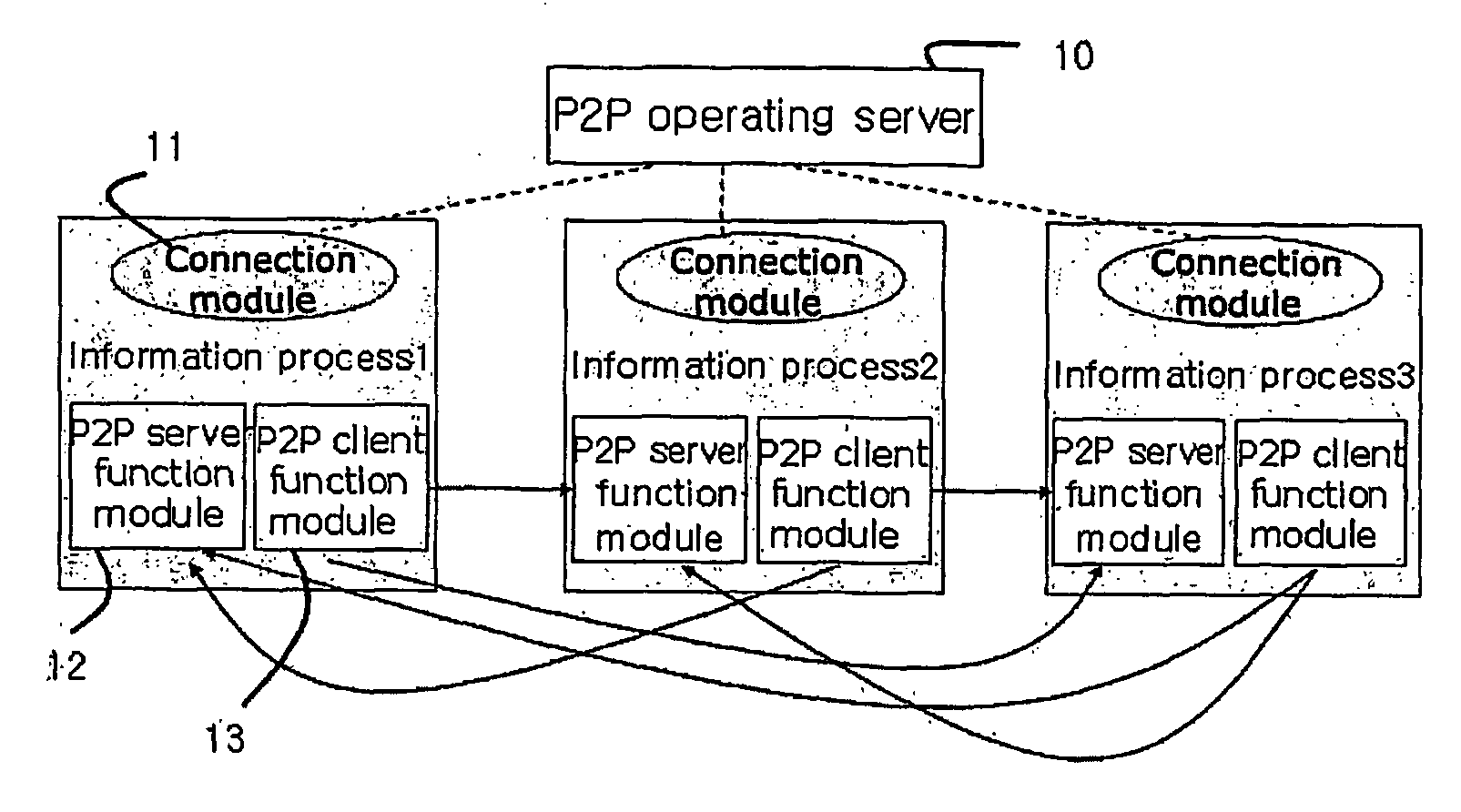

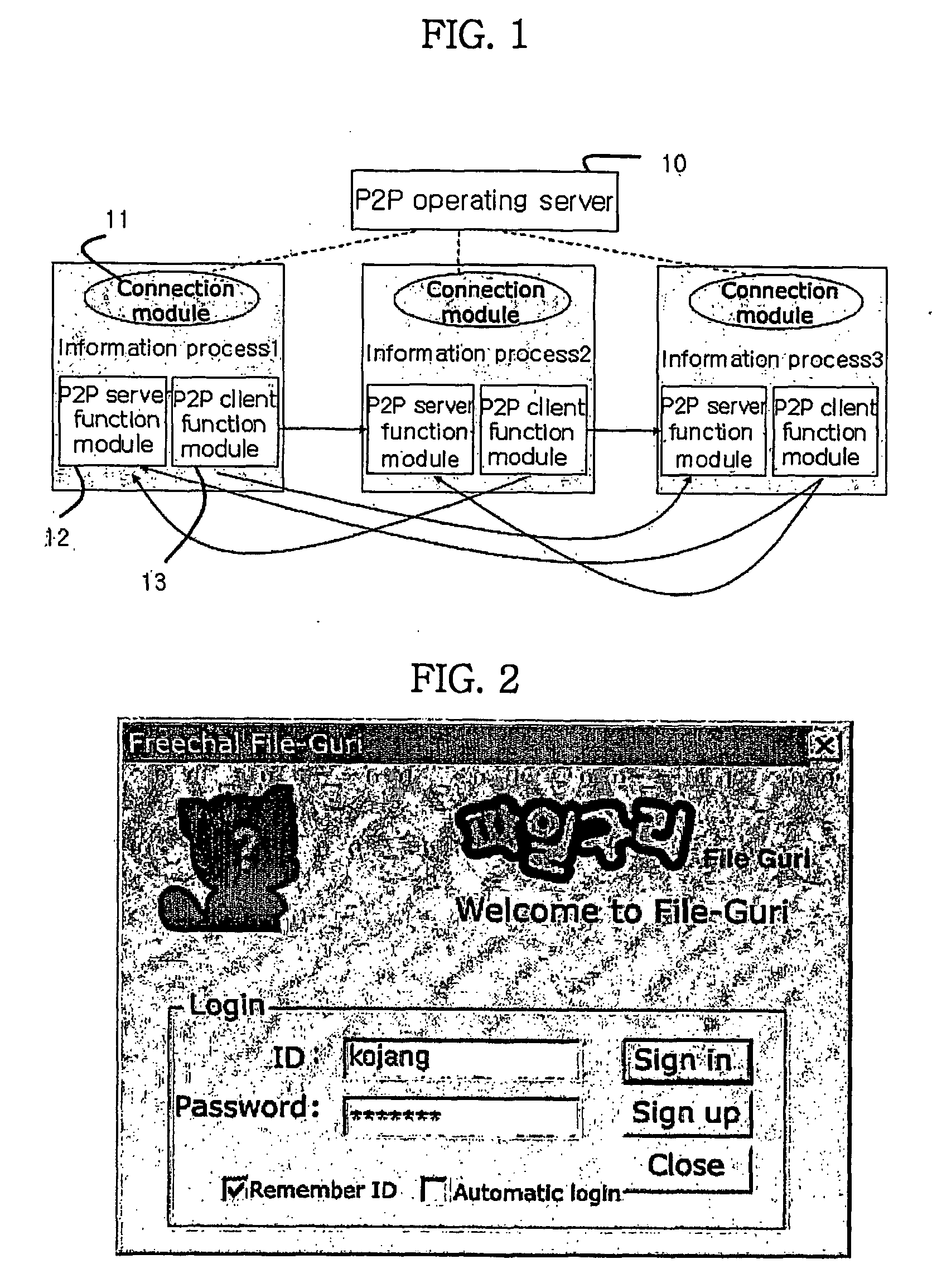

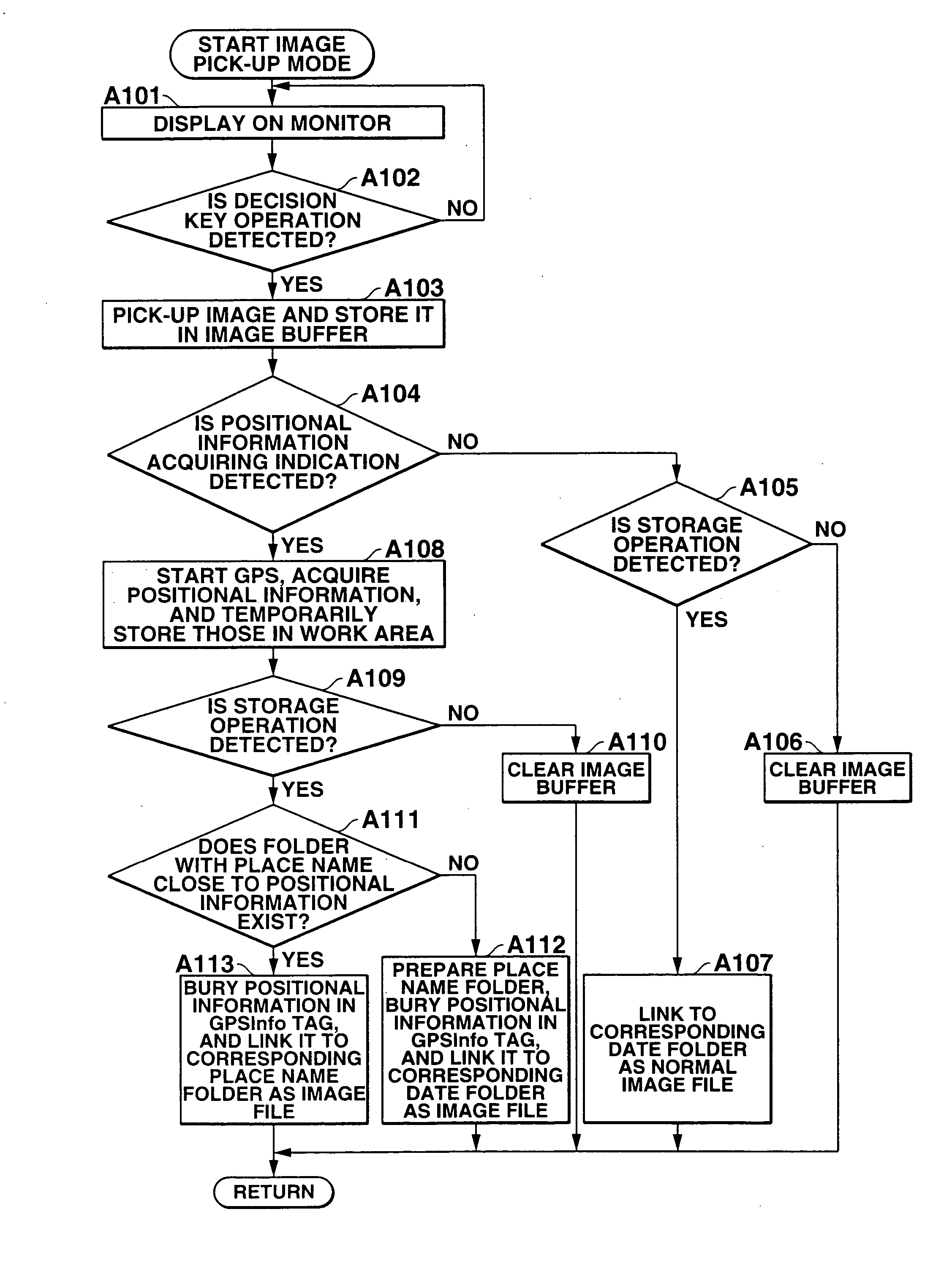

P2p service method

InactiveUS20060265467A1Digital data information retrievalMultiple digital computer combinationsInformation processorComputer science

The present invention relates to a P2P service method, and more particularly, to a method of enabling paid members among users of information processors employing a P2P service to be treated preferentially and a method capable of providing other additional services. P2P service method according to the present invention is characterized by providing receiving a download request to download a predetermined file stored in a shared folder from another information processor, receiving member information including the type of a member and a holding point value held by the other information processor from the other information processor, determining, based on the member information, whether a user of the other information processor is a free member, if the user of the other information processor is the free member, comparing the holding point value to a file point value corresponding to the size of the file, and if the holding point value is larger than the file point value, transferring the file to the other information processor. According to the present invention, since P2P service companies providing a P2P service can provide a variety of services capable of preferentially treating paid members as compared to free members, conversion from free members to paid members can be induced. Thus, revenue of the P2P service companies can be assured. Further, the present invention can overcome several inconveniences caused due to the nature of the P2P during using the P2P service.

Owner:FREECHAL INC

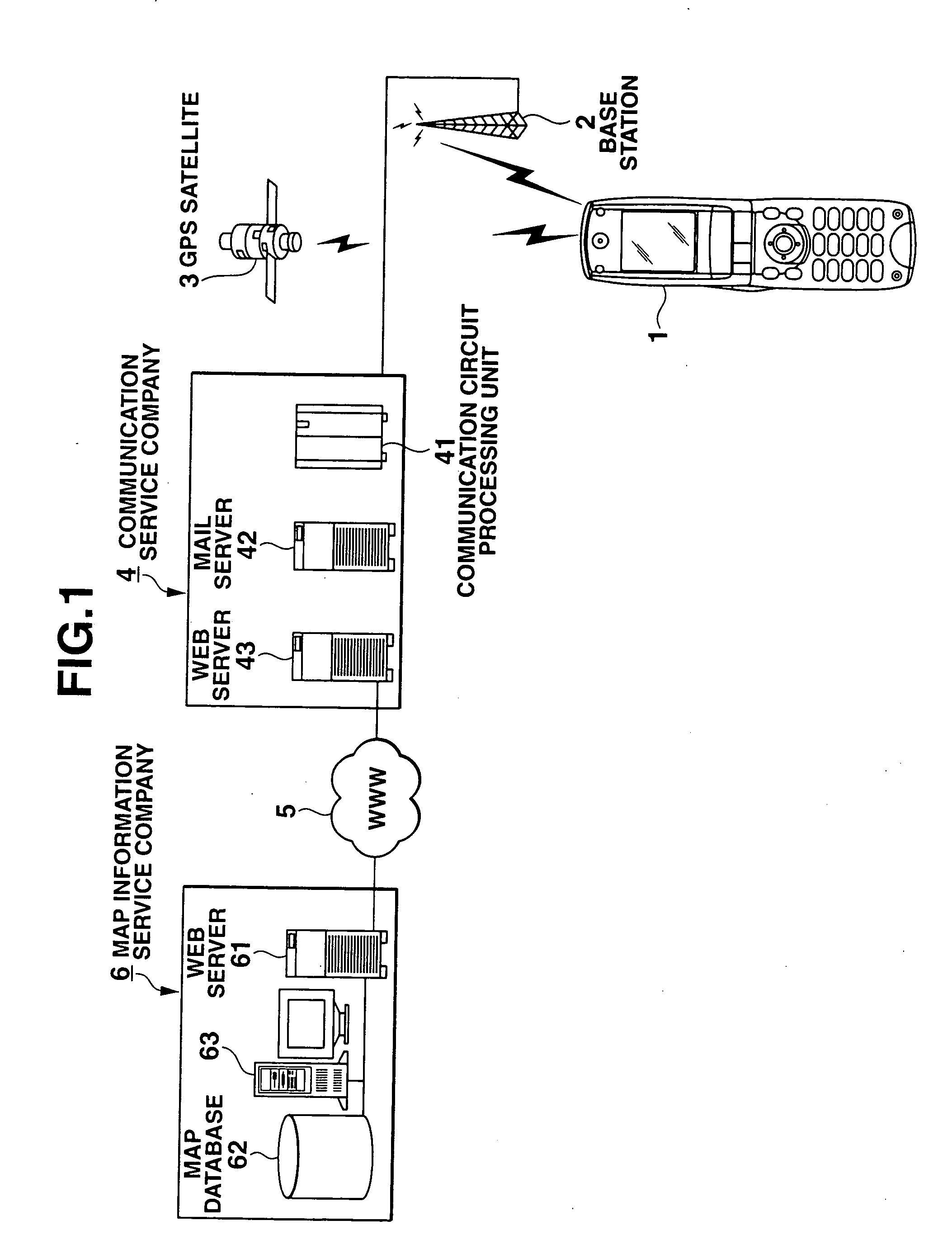

Electronic device, information display method, and information display program

InactiveUS20050041015A1Telephonic communicationCathode-ray tube indicatorsNetwork connectionElectronic equipment

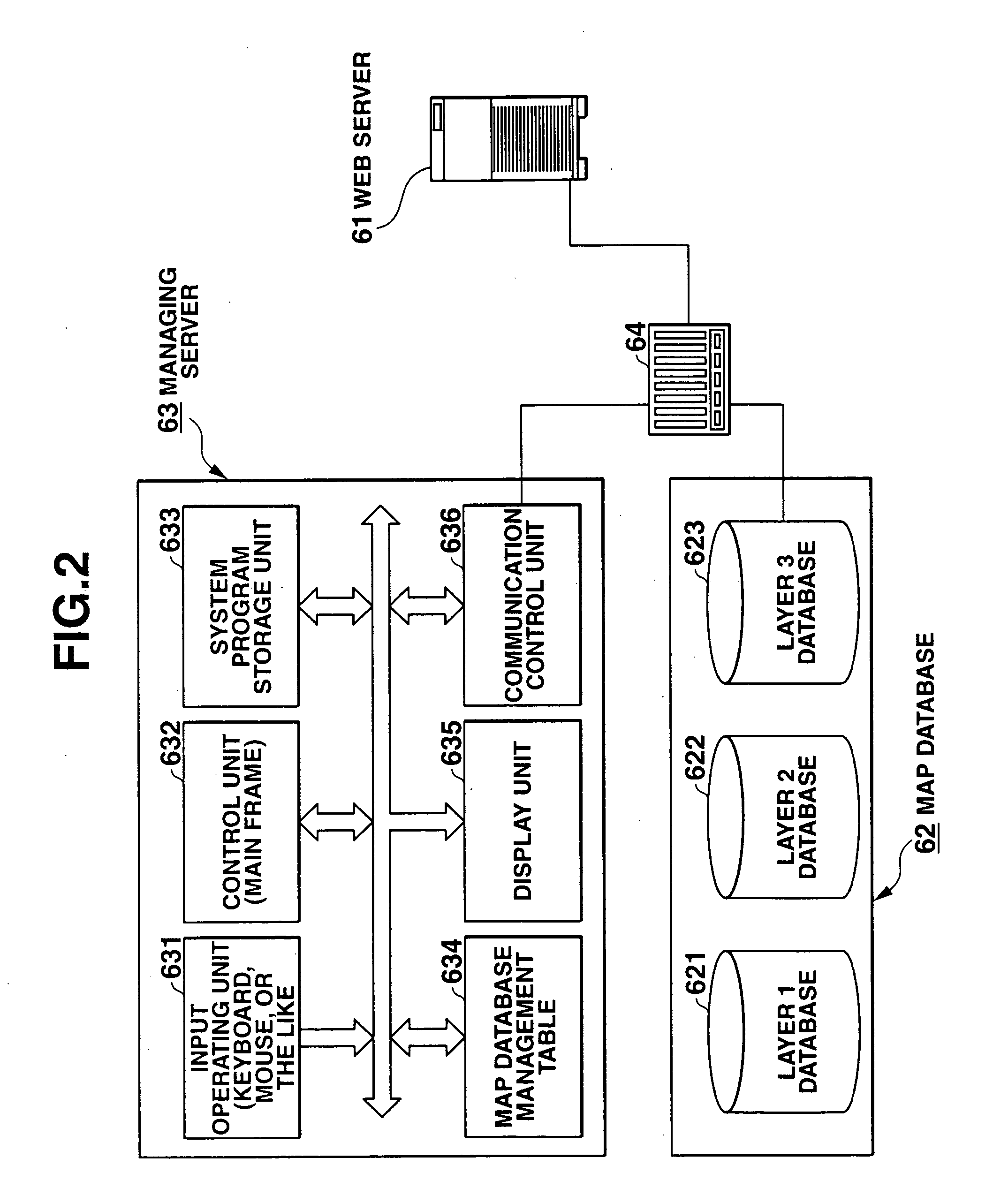

When a searching of an image file is indicated, a wireless telephone extracts image files and makes the image files to be icons, and displays the icons in a layout on a display unit. When a positional information acquiring indication is detected, the wireless telephone acquires self-positional information, centering on the acquired self-position, leaves only the image files to which the positional information are added, reads place name folders corresponding to the image files, and displays those in a layout. When one of the displayed icons is selected and a network connection indication is detected, the wireless telephone achieves a session with a map information service company, and transmits the self-positional information and the positional information which the selected image file includes, to the map information service company.

Owner:CASIO COMPUTER CO LTD

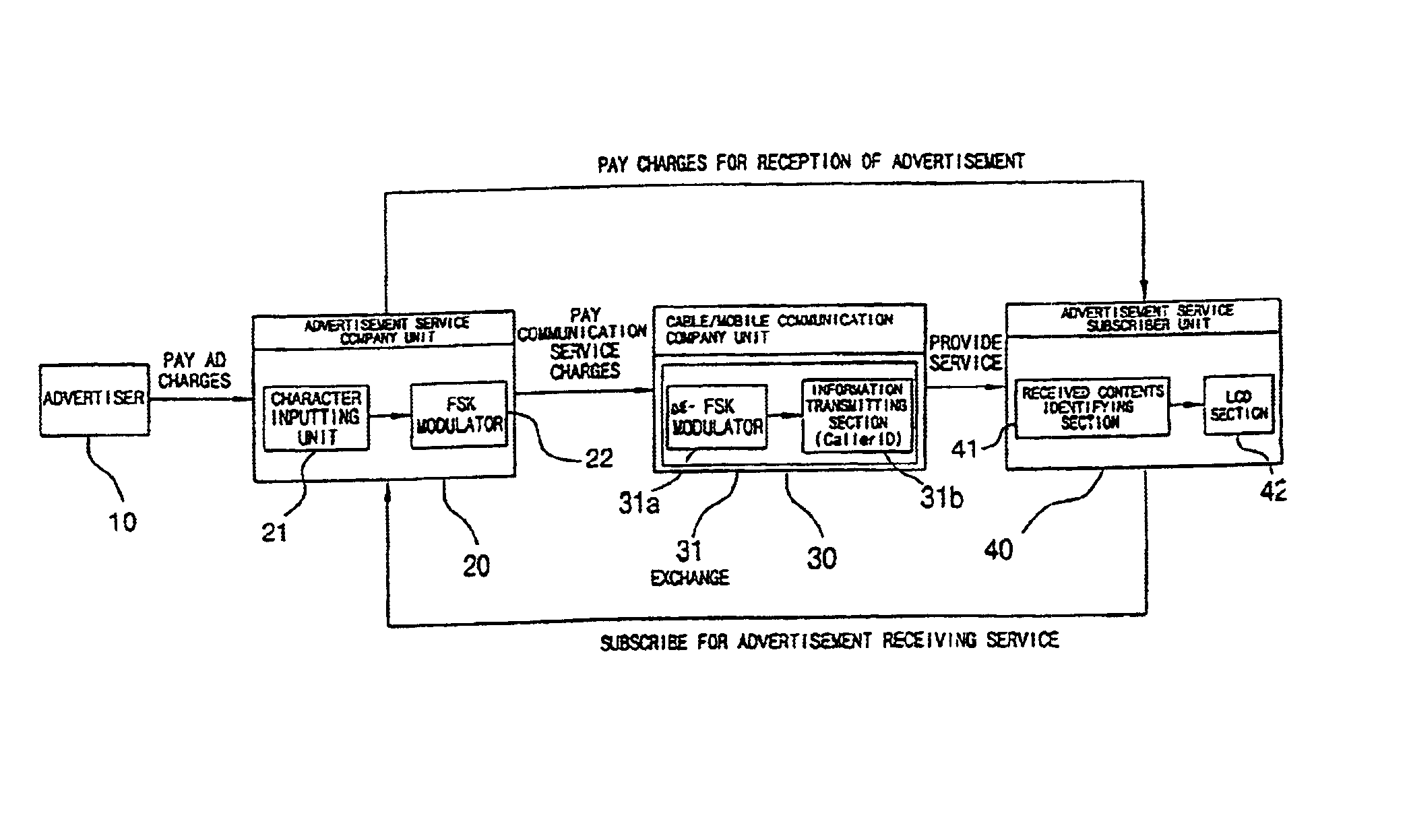

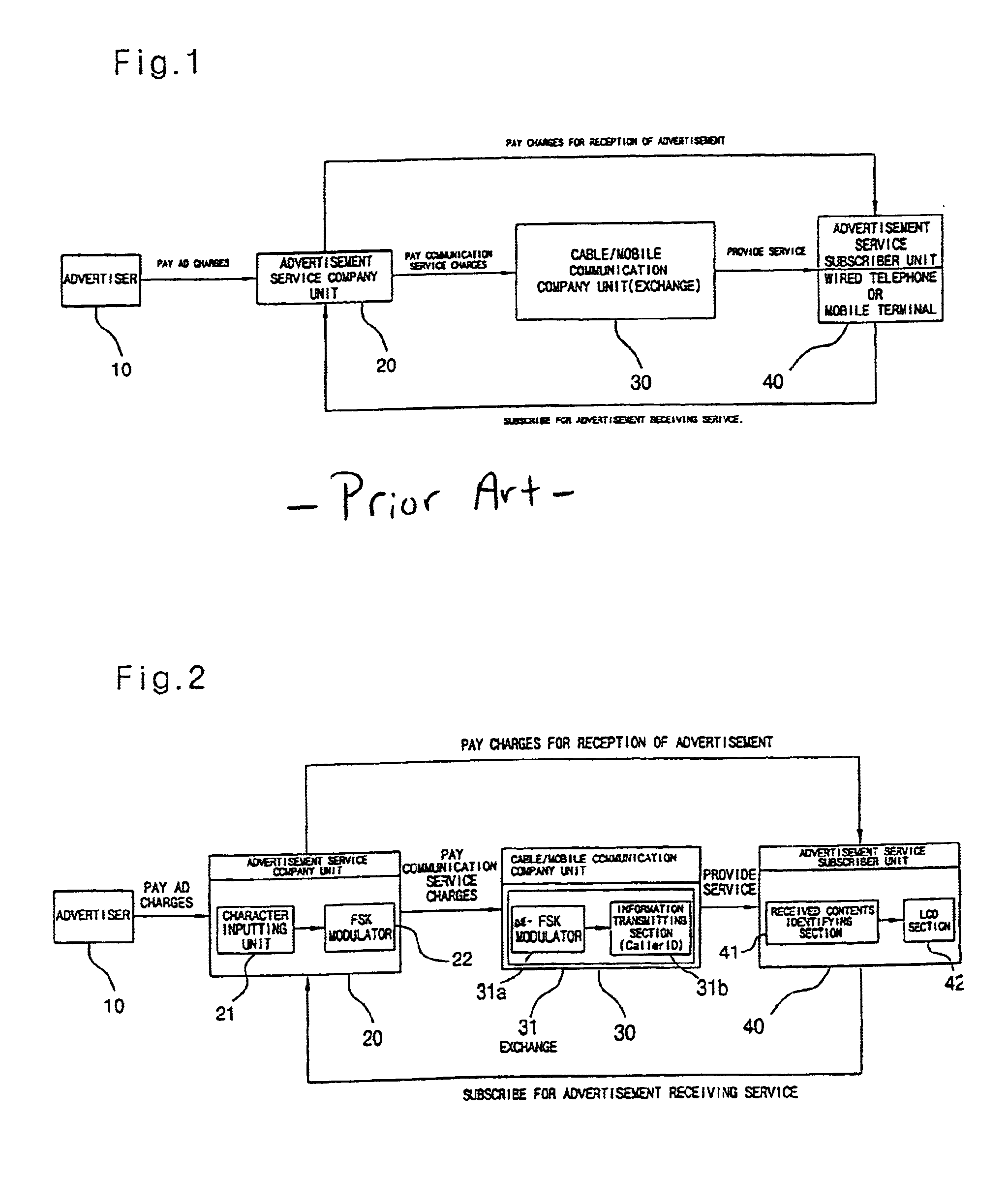

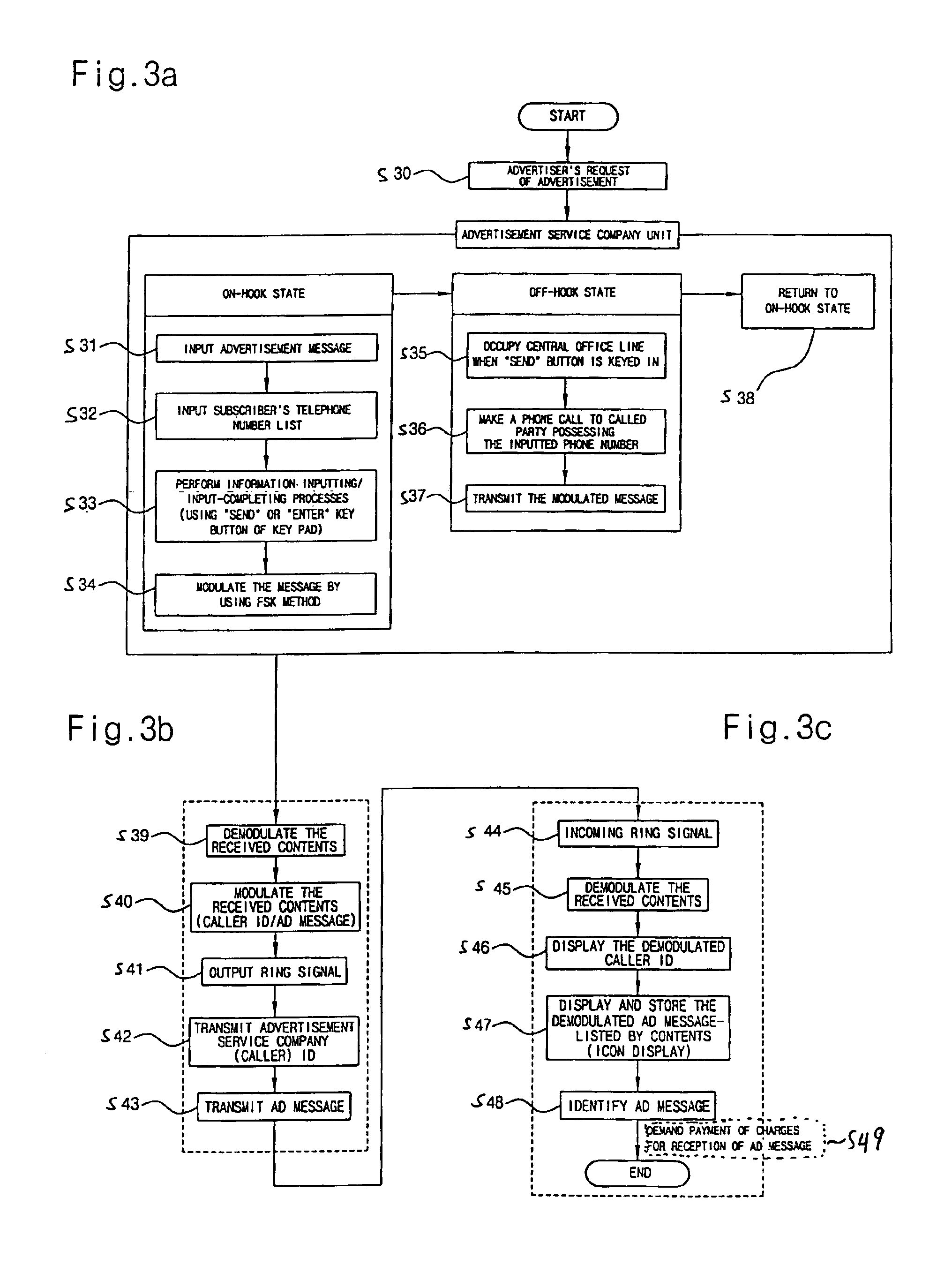

Method and apparatus for transmitting and receiving a message using caller ID

InactiveUS6952469B2Special service for subscribersCalled number recording/indicationComputer networkService user

Owner:LG ELECTRONICS INC

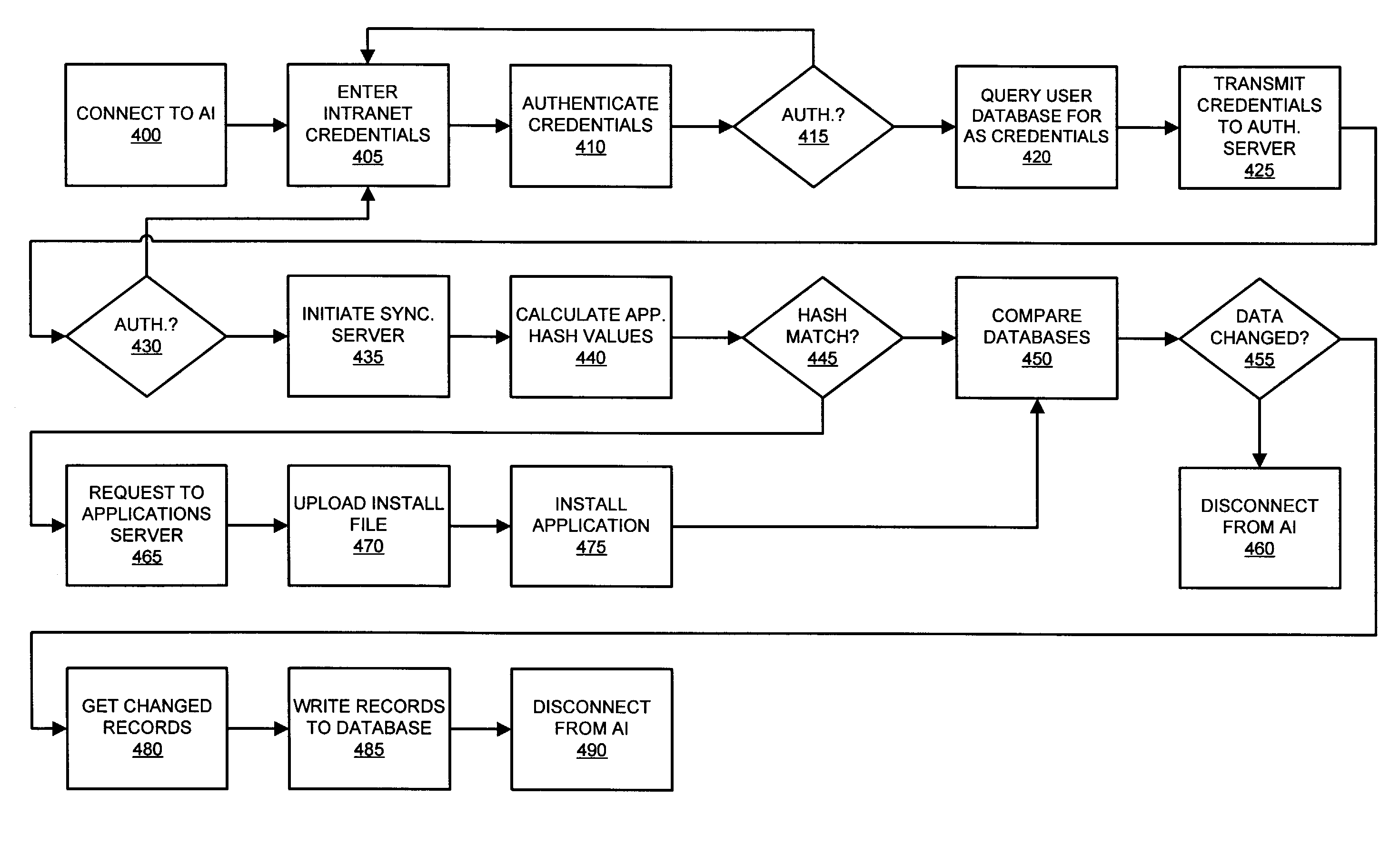

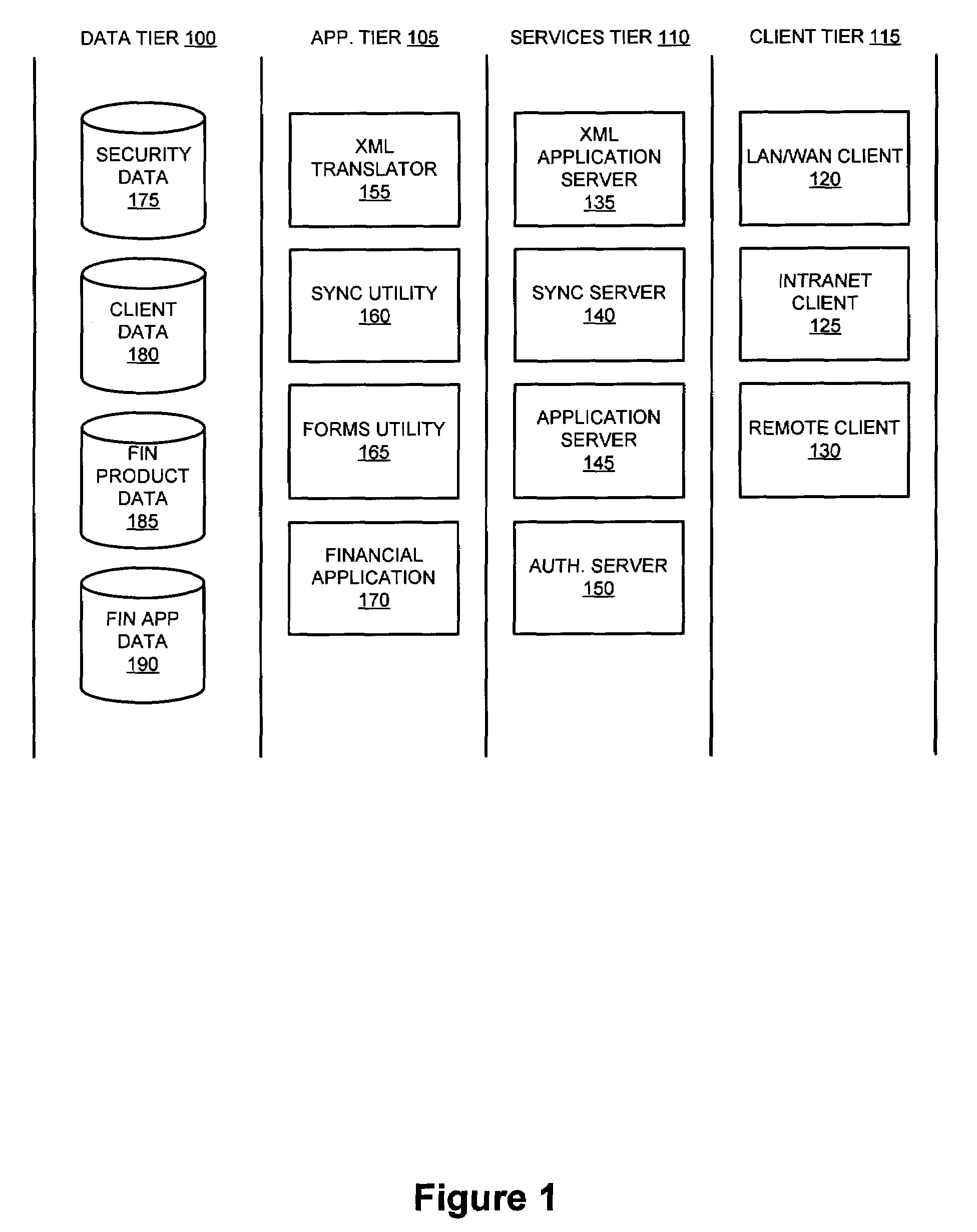

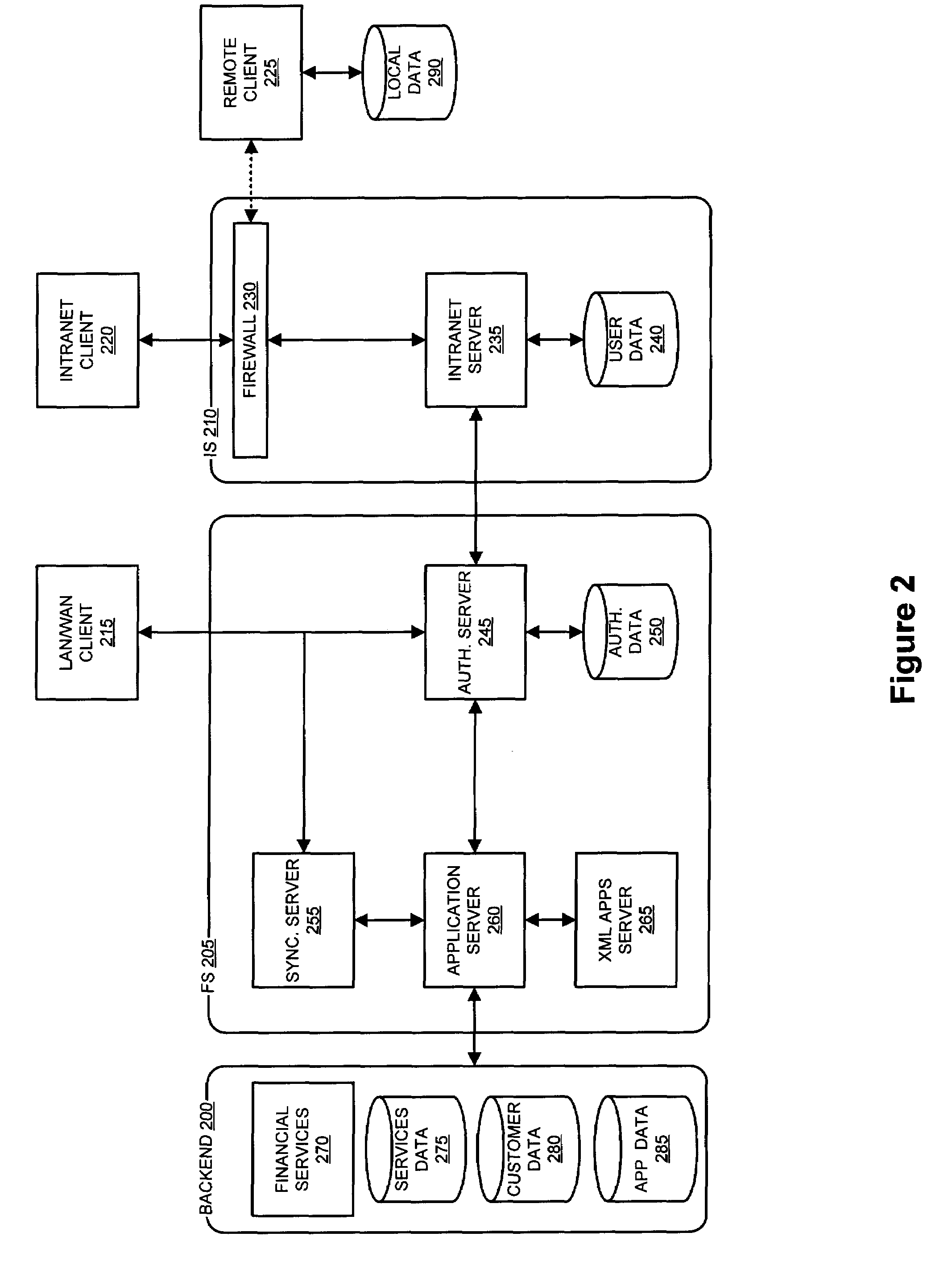

System and method for remote collection of data

Owner:AMERIPRISE FINANCIAL

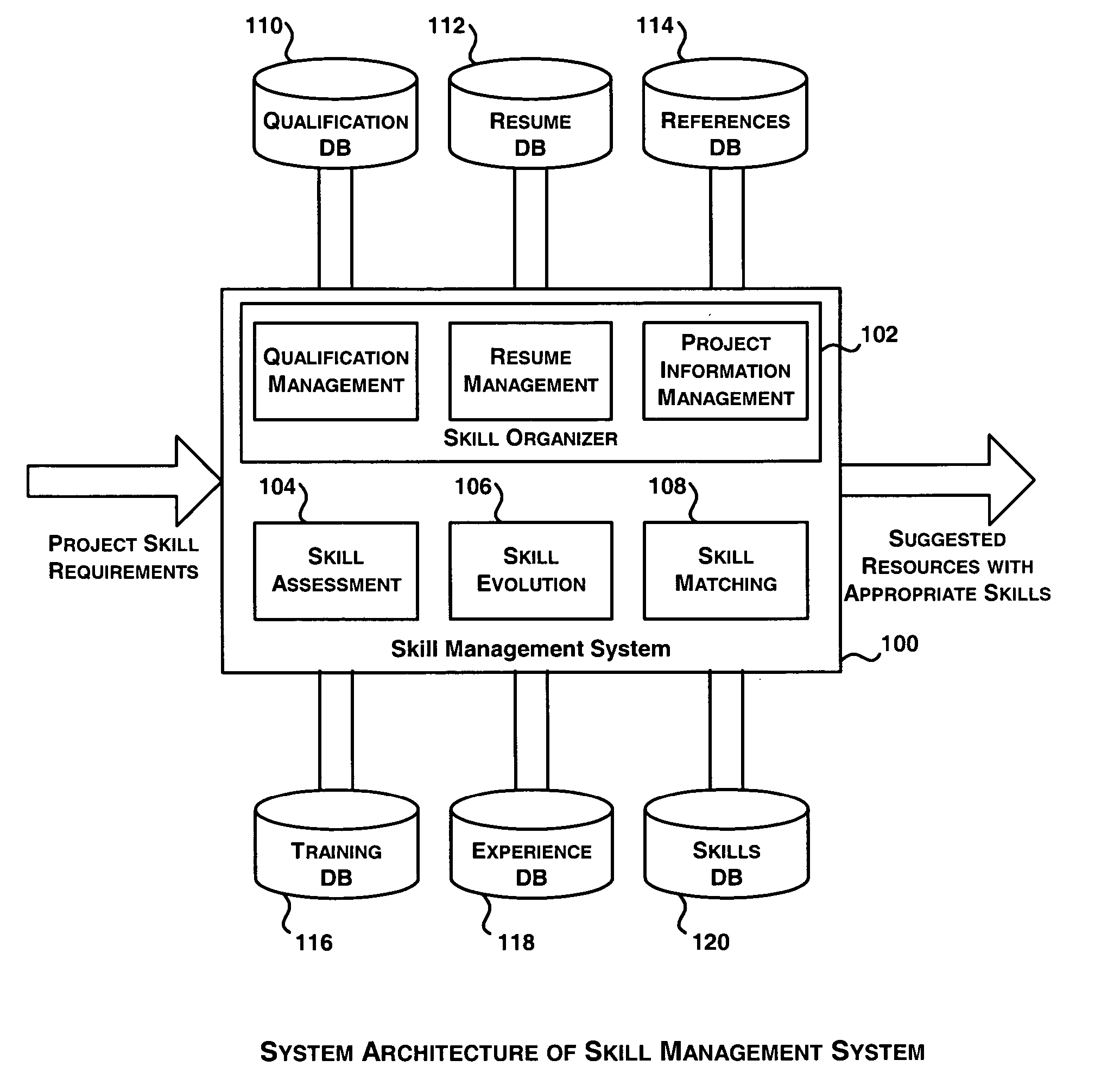

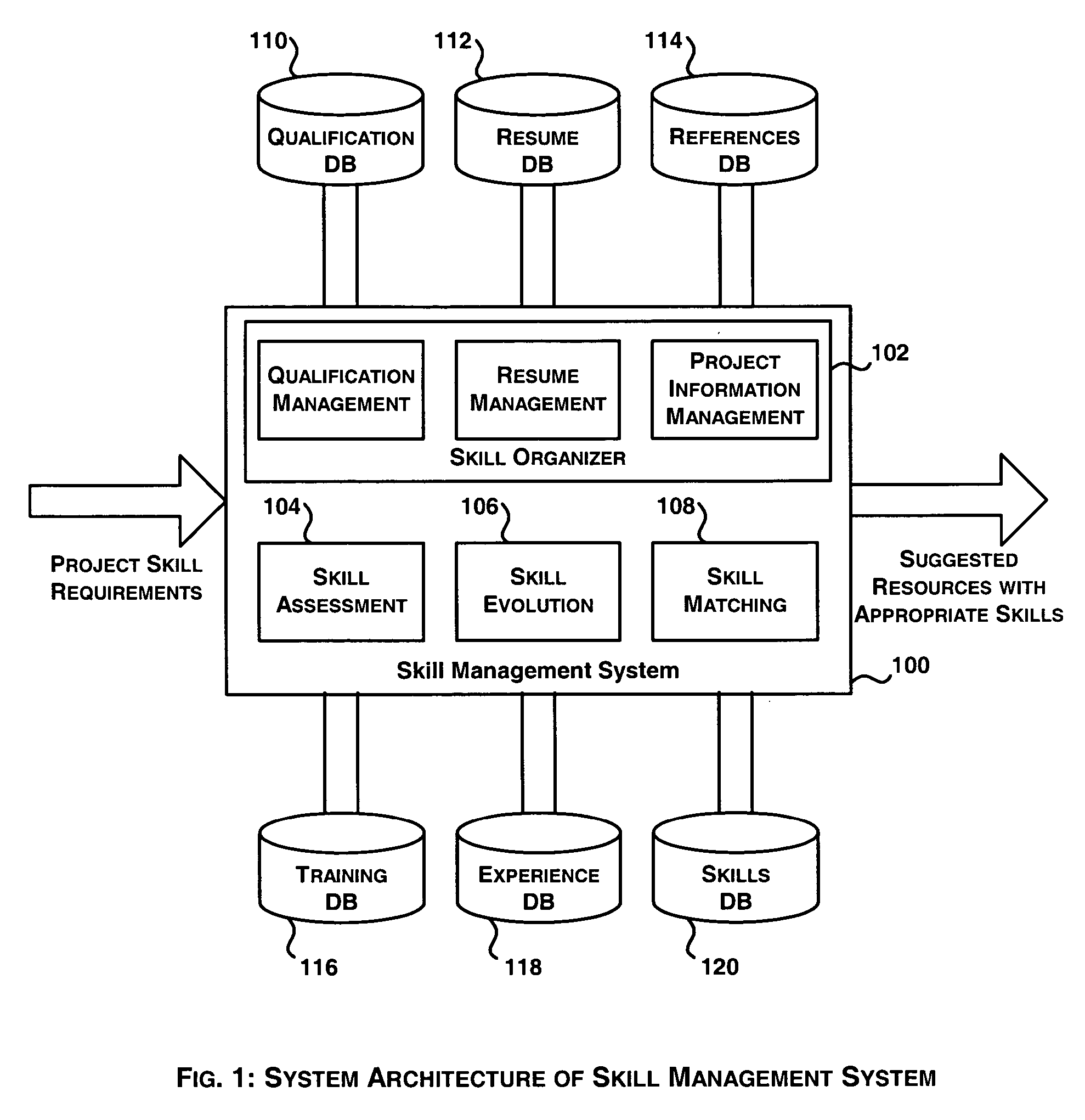

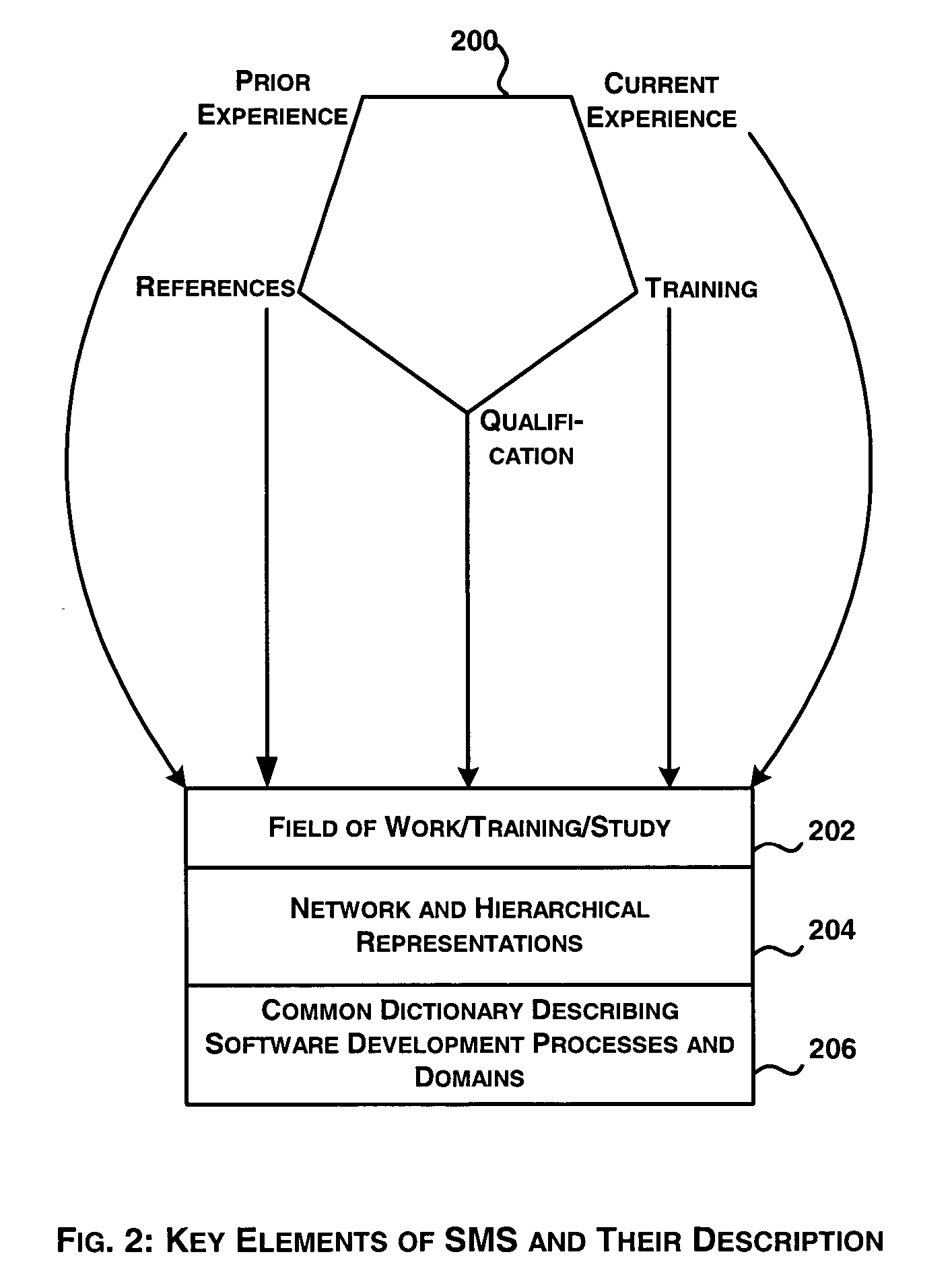

System and method for skill managememt of knowledge workers in a software industry

InactiveUS20050222899A1Special data processing applicationsInformation technology support systemSoftware development processSkills management

Workforce management enables enterprises to obtain best return on investment on workforce. Human capital forms a major investment in software services companies and effective management of these human resources has a greater impact on the overall profitability of such companies. Manual approaches for workforce management may lead to less optimal utilization of resources. A system for skill management of knowledge workers involves (a) obtaining the skills of a resource on joining; and (b) tracking the skill enhancements and additional skills acquired by the resource subsequently. The factors that largely affect the skills of a resource are qualification of the resource, trainings undergone by the resource, and projects executed by the resource. These aspects are represented using a common dictionary describing software development processes and relevant domains. Such a representation and an up-to-date skill information enables a near-optimal allocation of right resources to meet the requirements of new projects. An overall network based skill management system comprising a plurality of interconnected local skill management systems with a central skill manager helps in achieving a near-optimal utilization of resources distributed geographically.

Owner:SATYAM COMP SERVICES

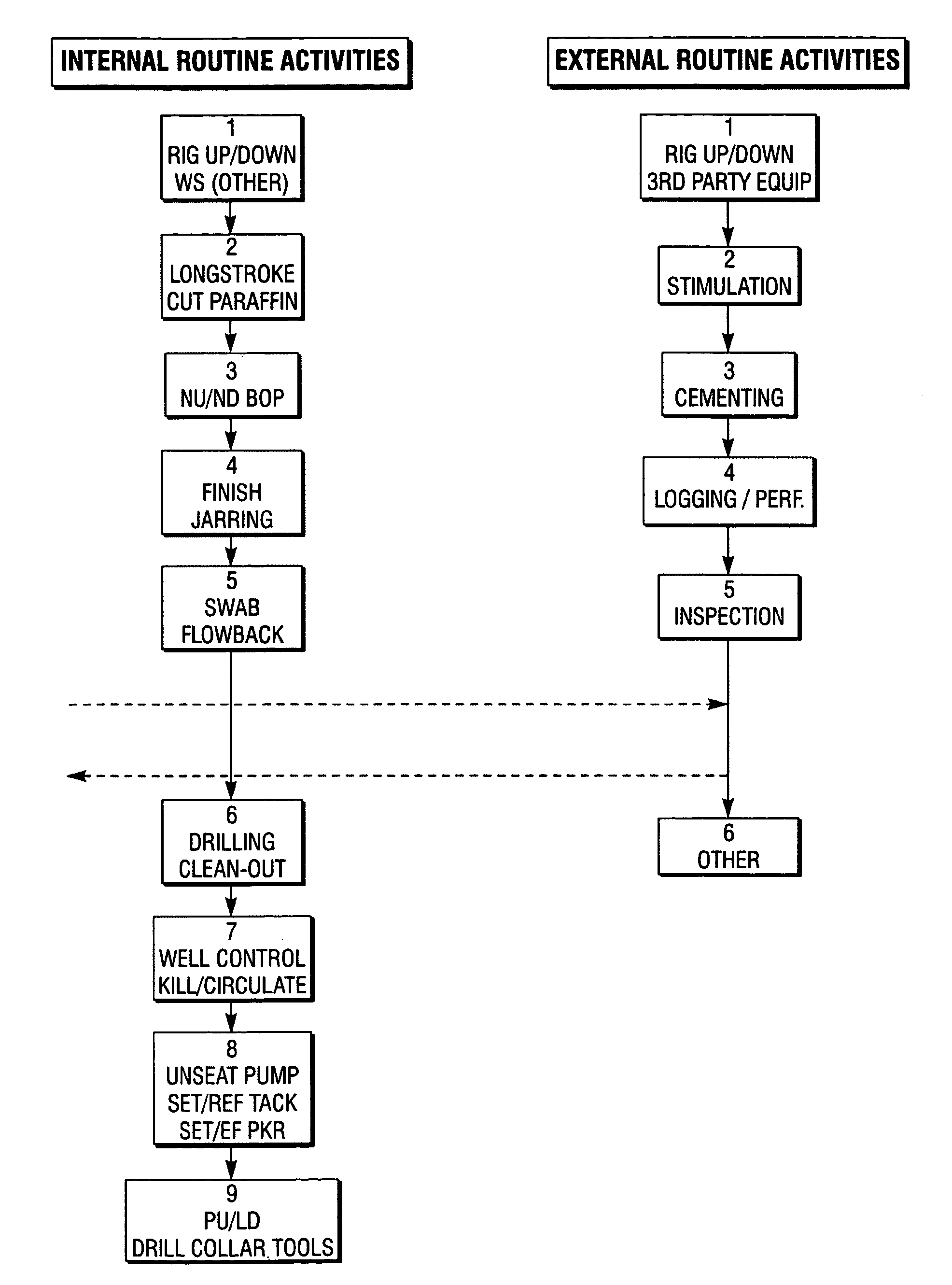

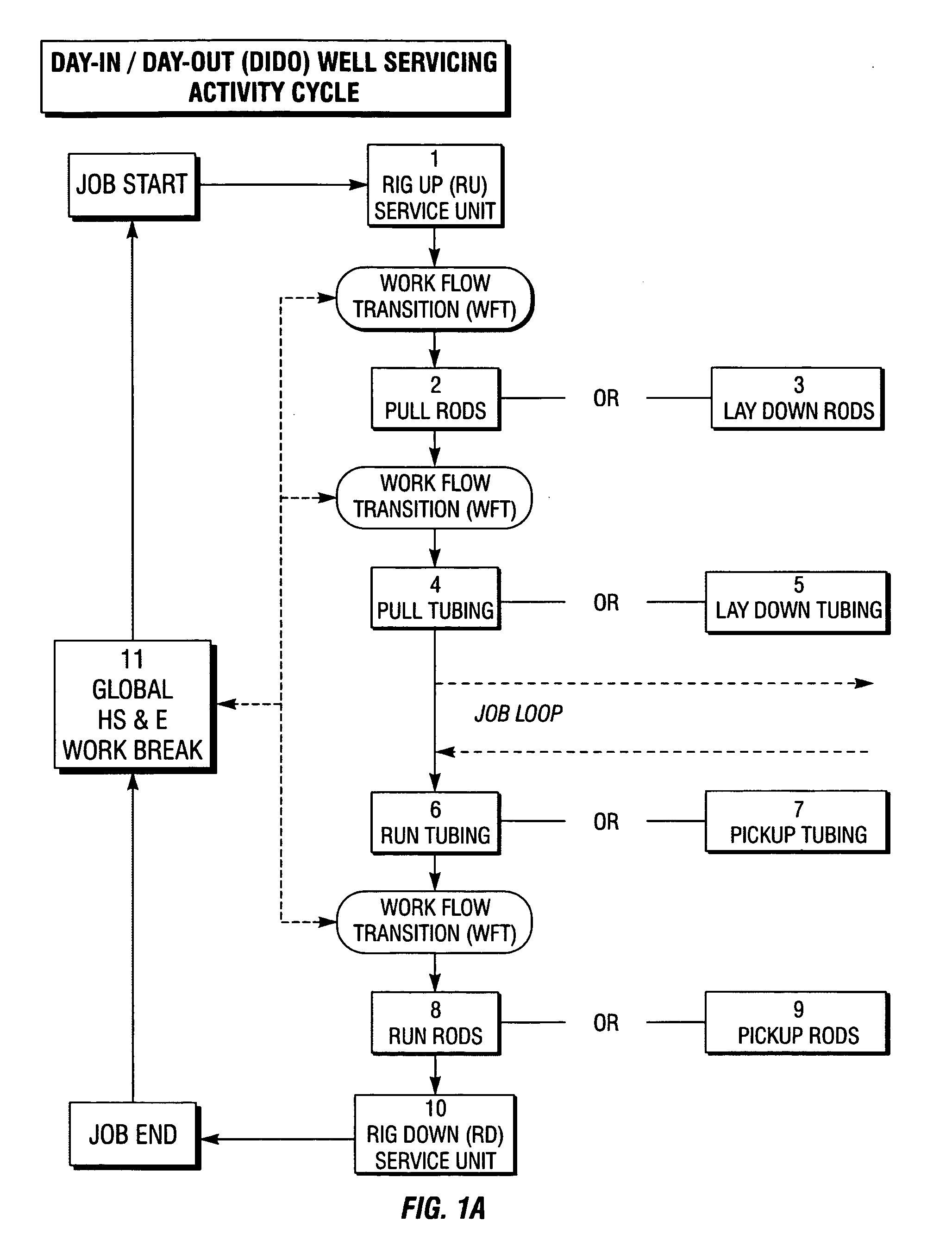

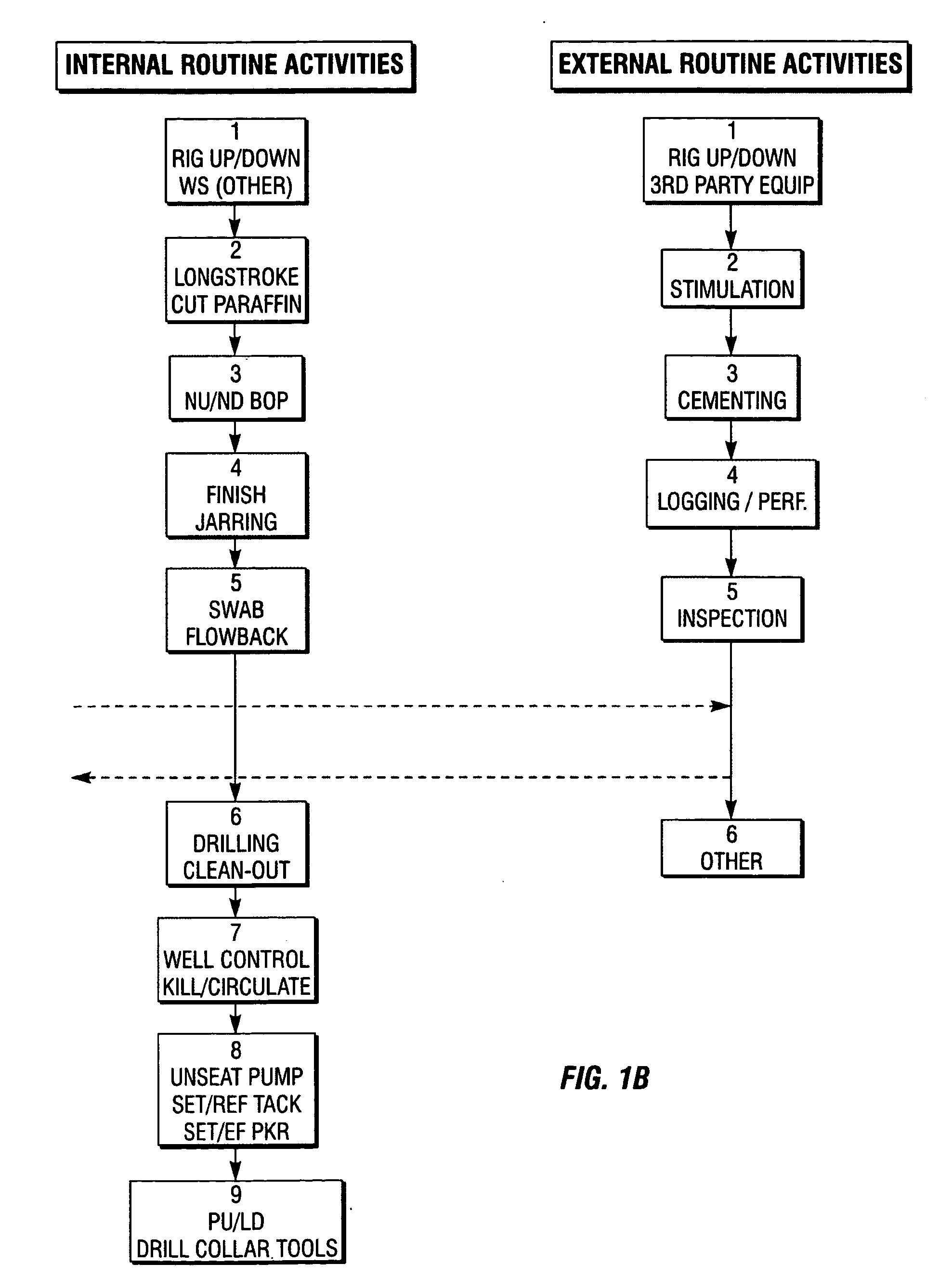

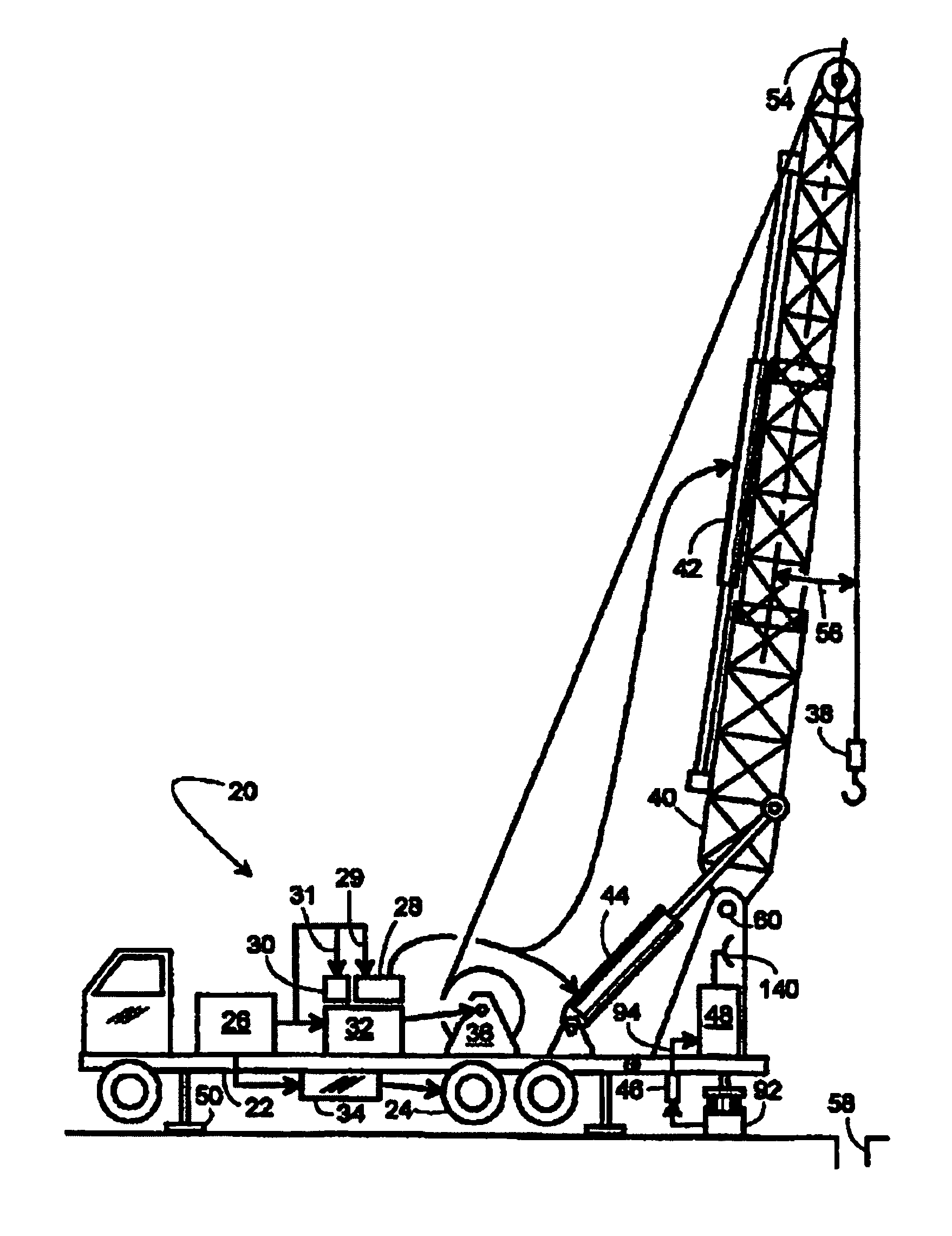

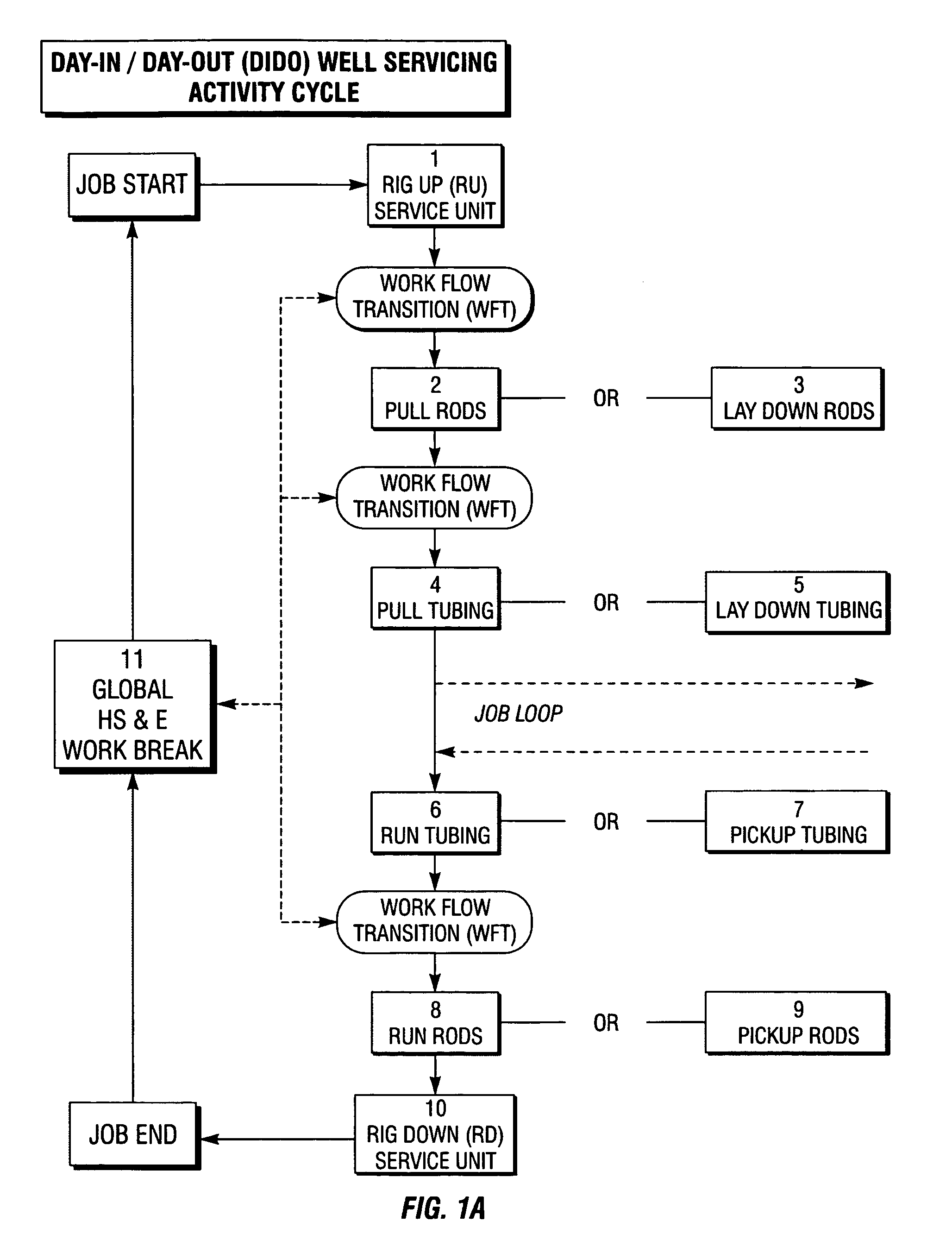

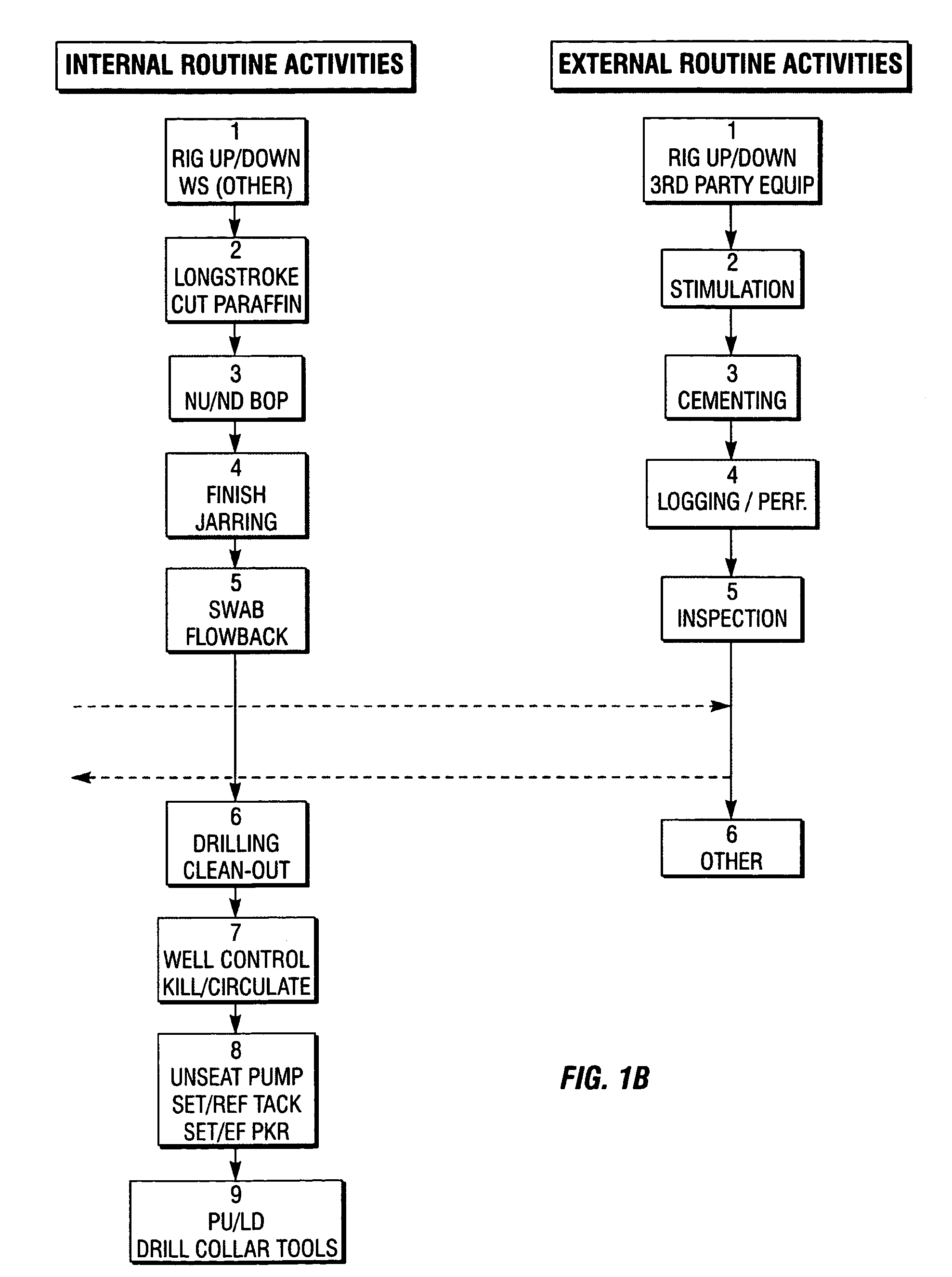

Activity data capture system for a well service vehicle

ActiveUS20050103491A1Improve the security environmentImprove productivitySurveyDrilling rodsData centerWeb based database

The present invention is directed to incrementing a well service rig in such a manner that activity-based and / or time-based data for the well site is recorded. The invention contemplates that the acquired data can be transmitted in near real-time or periodically via wired, wireless, satellite or physical transfer such as by memory module to a data center preferably controlled by the work-over rig owner, but alternately controlled by the well owner or another. The data can thereafter be used to provide the customer in various forms ranging from a detailed invoice to a searchable, secure web-based database. With such information, the customer can schedule other services at the well site. Further, the customer will have access to detailed data on the actual service performed and can. The present invention fosters a synergistic relationship among the customer and the service companies that promotes a safe environment by monitoring crew work activities and equipment speeds; improving productivity; reducing operation expenses through improved job processes; and better data management and reduced operational failures.

Owner:KEY ENERGY SERVICES

On-vehicle breakdown-warning report system

InactiveUS20060020380A1Shorten the timeVehicle testingRegistering/indicating working of vehiclesDiagnostic dataElectronic control system

An on-vehicle breakdown-warning report system is disclosed. an occurrence of break-down is detected and judged based on a signal in an electronic control system installed on a control apparatus for an engine ignition system, a charging system, an engine fuel system, a engine cooling system, a power transmission system, and an oil lubricating system of an automobile or a diagnosis display system; and a diagnostic data is sent to an information terminal device of a diagnosis and maintenance agency or a service company having a diagnosis and maintenance agency as a contents information by using an on-vehicle mobile communication apparatus, and an action for an emergency measures and a maintenance schedule is asked.

Owner:HITACHI LTD

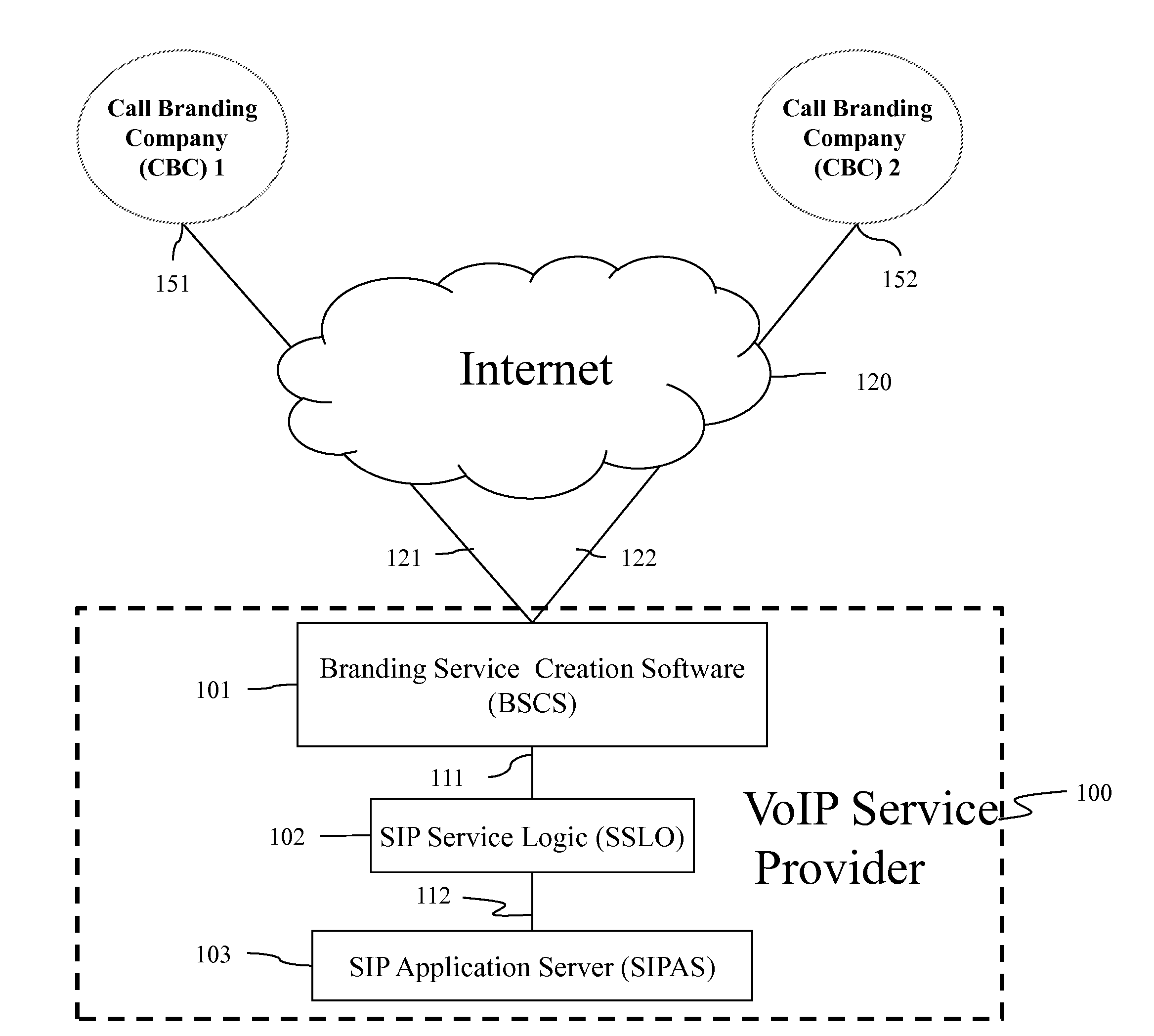

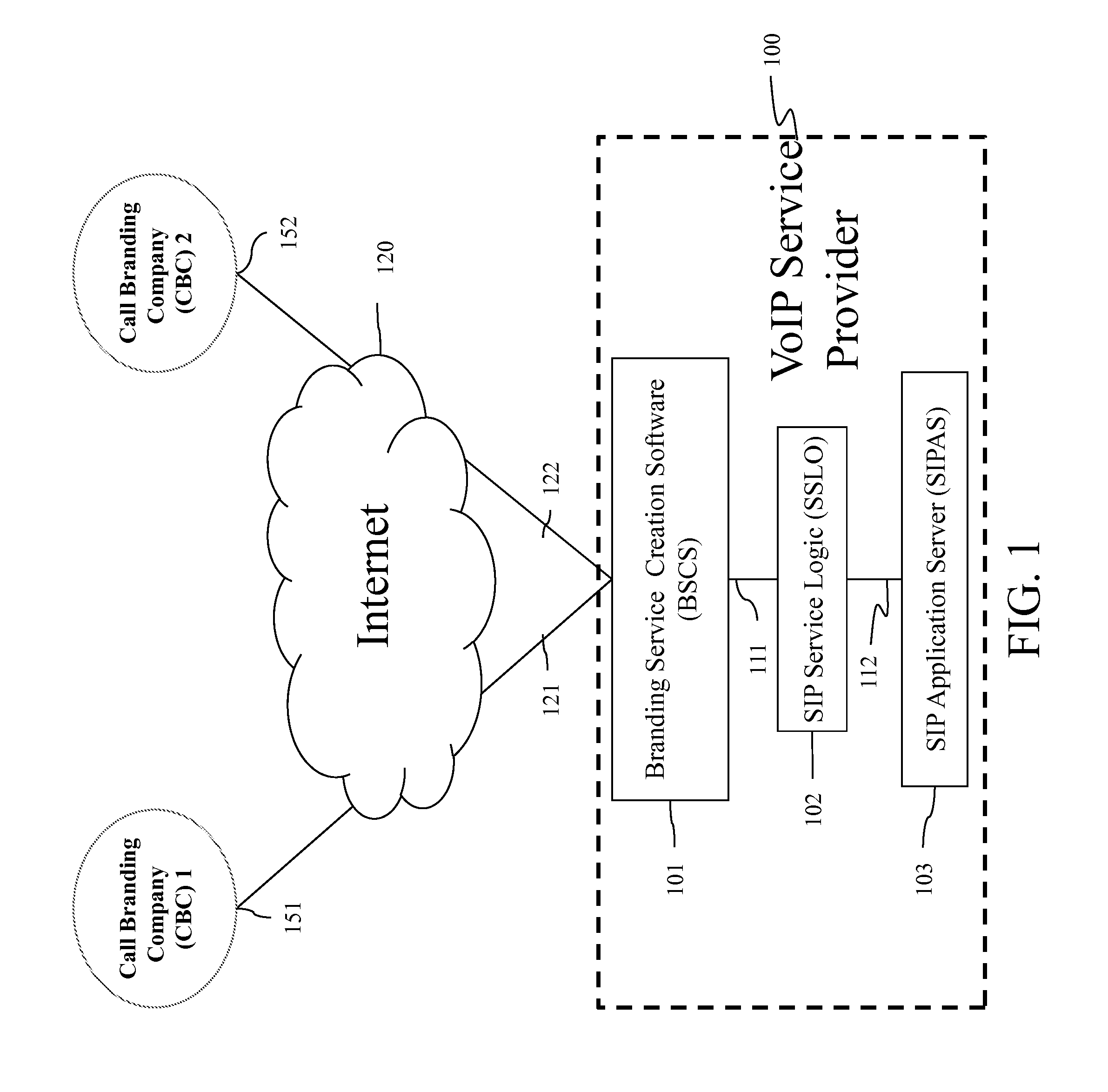

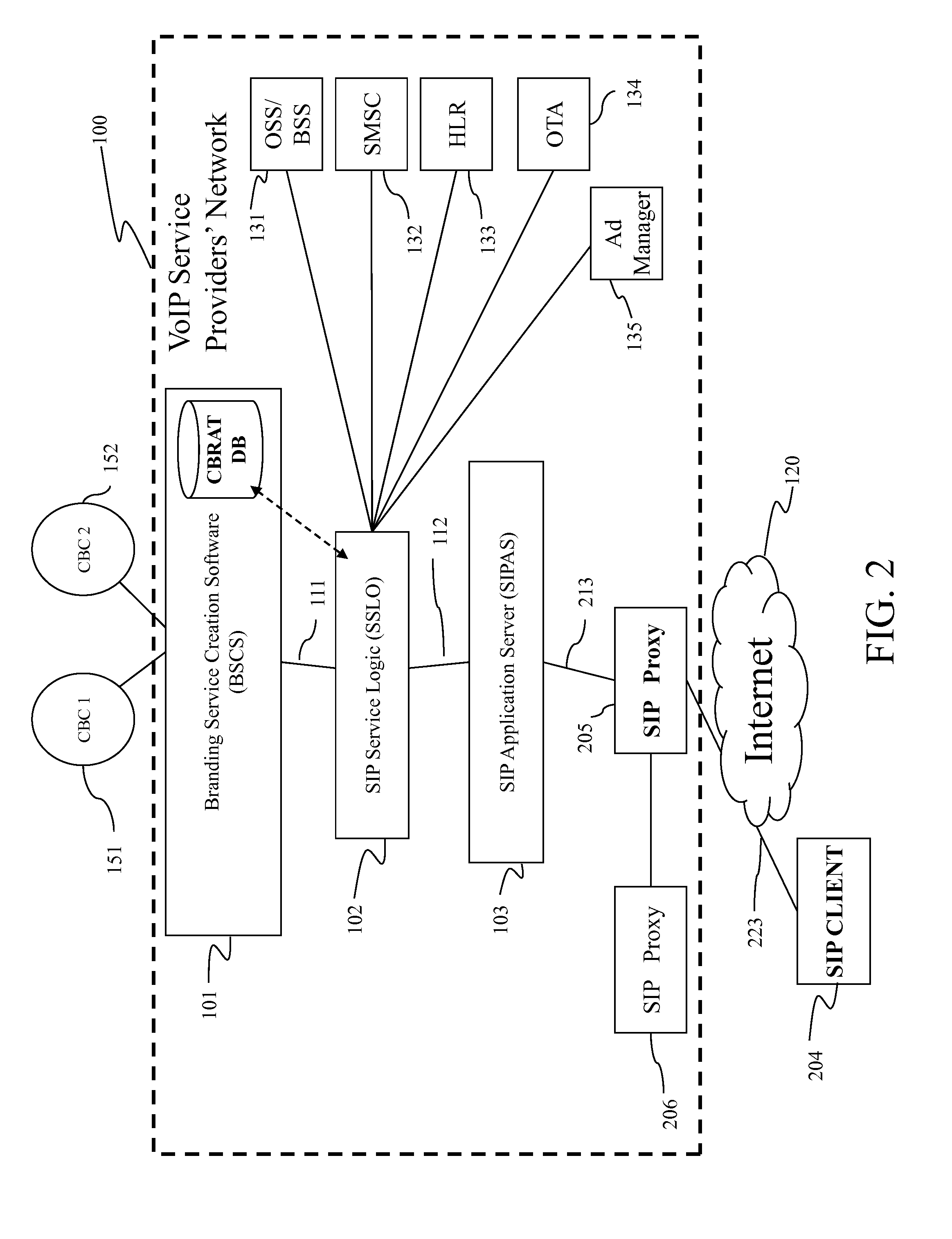

Branded VOIP service portal

A method is provided for a Voice over IP (VoIP) Operator to enable another entity, the call branding company, to offer a phone service of its own brand using that VoIP service company's physical service infrastructure which includes, for example, the VoIP client application, the VoIP network elements, and provisioning, billing and ordering systems, the method including the steps of receiving an incoming VoIP call over a network from a caller's VoIP client, matching one or more parameters of the incoming call against one or more call branding activation triggers; and, in the event of a match, applying call branding to the VoIP call as specified by a call branding configuration profile associated with the matched call branding activation trigger. Additional methods of applying call branding provided include the call branding company setting up a call branding configuration profile with the VoIP service provider, the call branding configuration profile including one or more call branding activation triggers, advertisements, VoIP soft-phone client skins, VoIP service options, sponsorship details and call redirection / forwarding rules.

Owner:ARGELA USA

Household energy management sytem

ActiveUS20110035060A1Easy to useLow costLevel controlSpecial tariff metersProcess engineeringHome appliance

A household energy management system uses measurements of the household electricity supply to identify and to determine the energy consumption of individual household appliances. From these measurements, models can be built of the behavior of the occupants of the house, the thermal properties of the house and the efficiency of the appliances. Using the models, the household appliances—in particular heating and cooling appliances—can be controlled to optimize energy efficiency; and maintenance programs for the appliances and for the house itself can be recommended to the householder or arranged with a service company.

Owner:CENTRICA HIVE LTD

Activity data capture system for a well service vehicle

ActiveUS7006920B2Improve the security environmentImprove productivityElectric/magnetic detection for well-loggingDrilling rodsData centerWeb based database

The present invention is directed to incrementing a well service rig in such a manner that activity-based and / or time-based data for the well site is recorded. The acquired data can be transmitted via wired, wireless, satellite or physical to a data center preferably controlled by the work-over rig owner, but alternately controlled by the well owner or another. The data can thereafter be used to provide the customer a detailed invoice or a searchable, secure web-based database. With such information, the customer can schedule other services at the well site. Further, the customer will have access to detailed data on the actual service performed. The present invention fosters a synergistic relationship among the customer and the service companies that promotes a safe environment by monitoring crew work activities and equipment speeds; improving productivity; reducing operation expenses through improved job processes; and better data management and reduced operational failures.

Owner:KEY ENERGY SERVICES

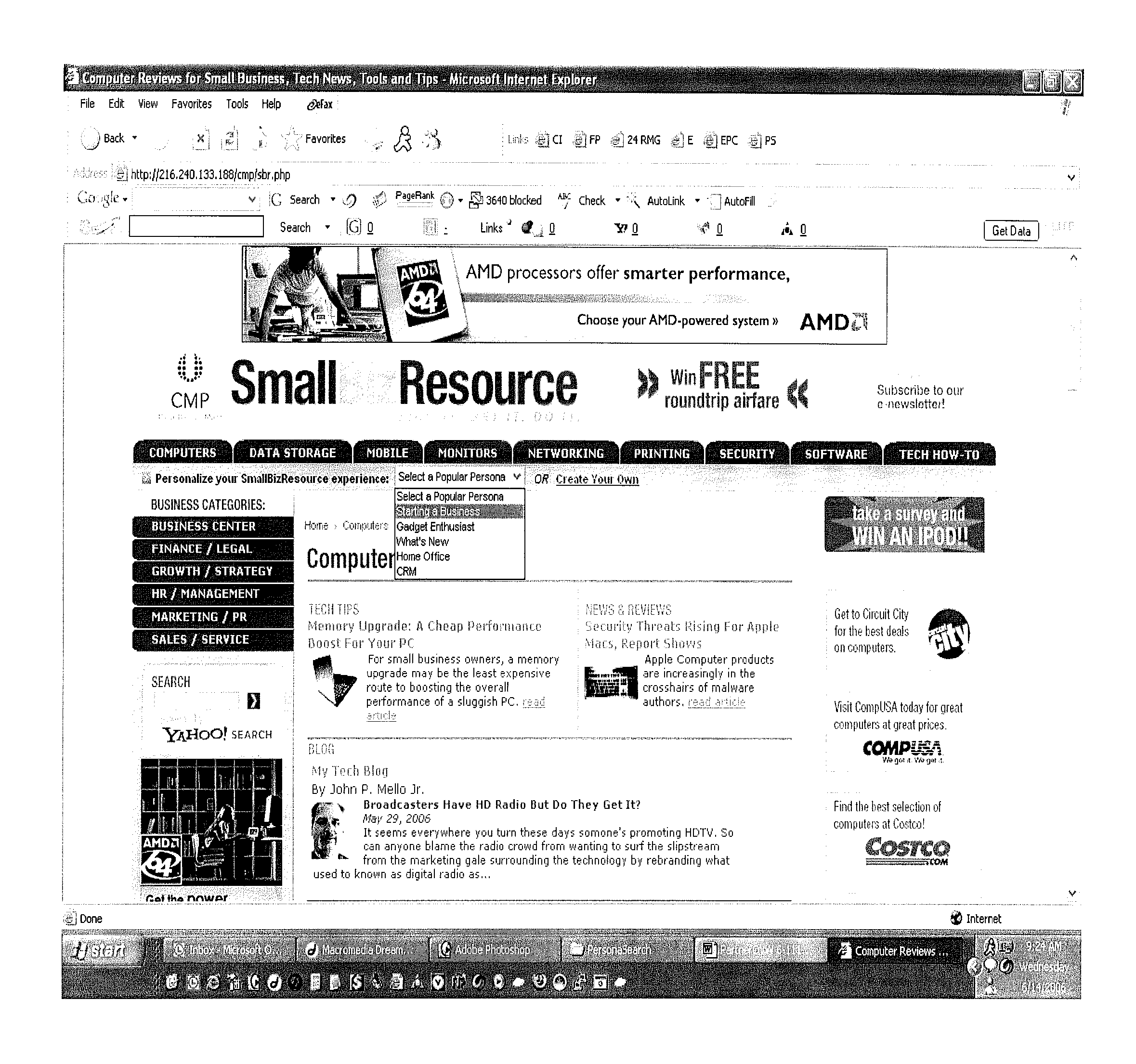

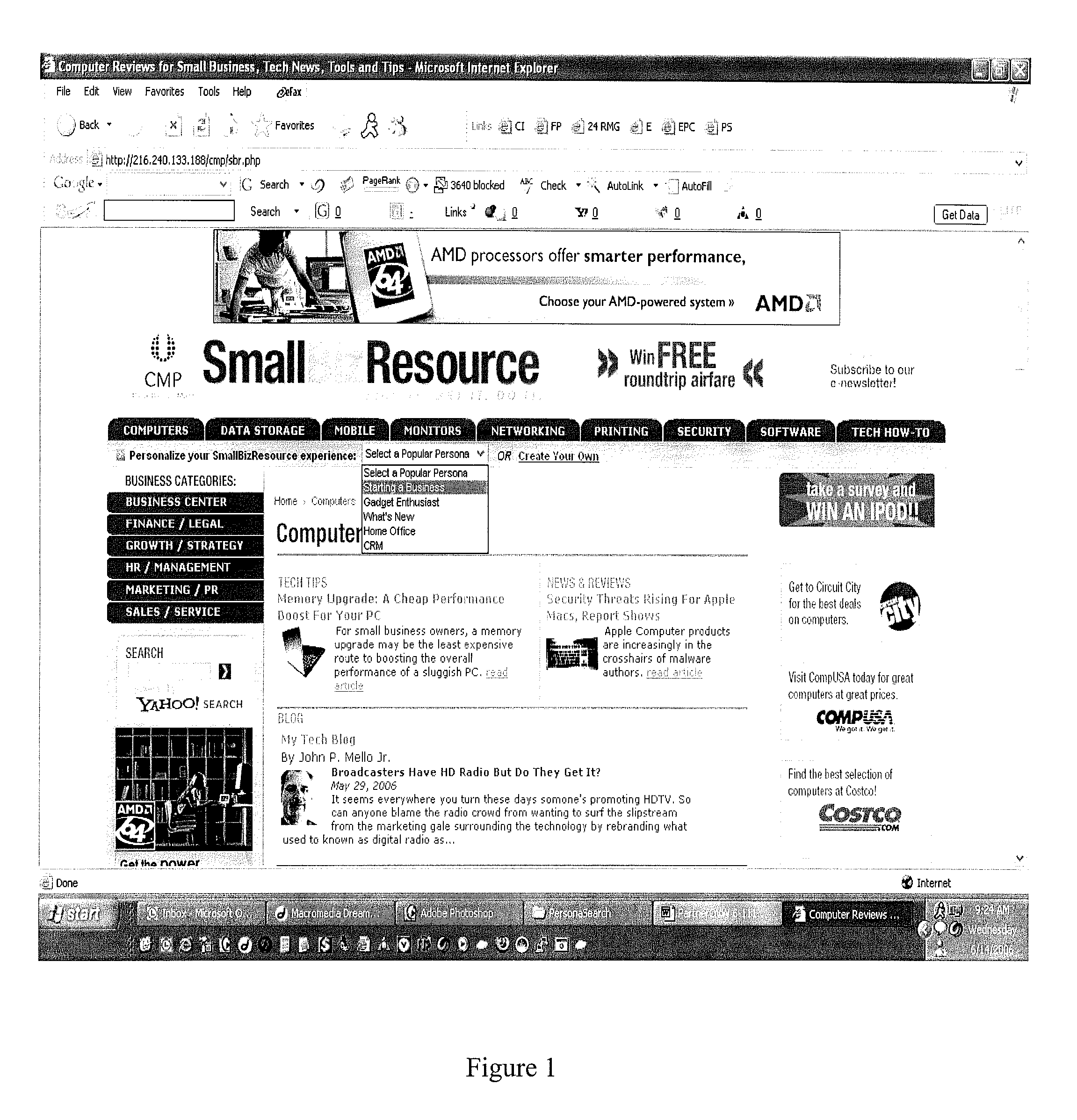

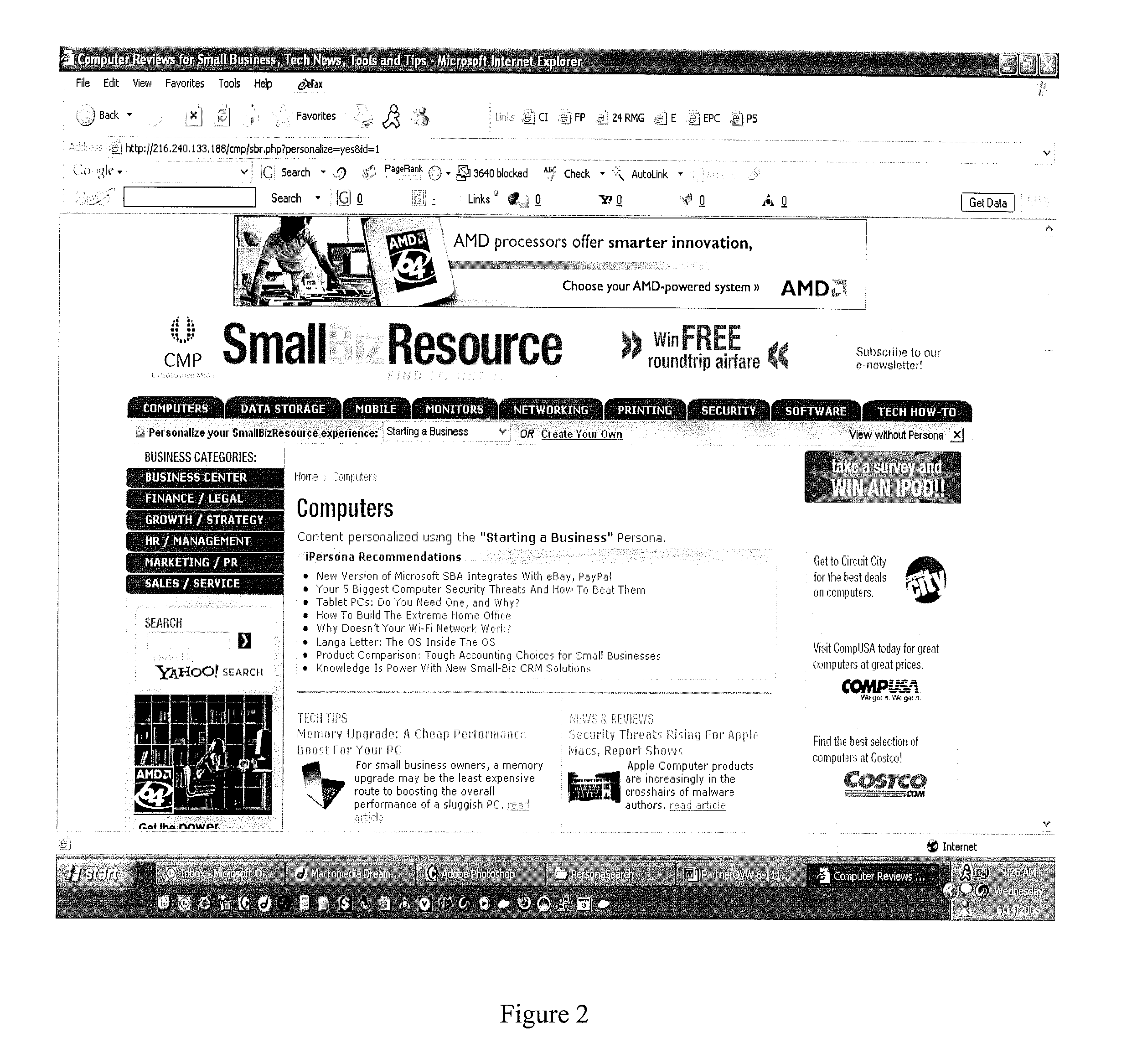

Systems and Methods for Using Personas

The present invention provides systems and methods for increasing 3rd party advertising on an interactive site, by assigning characteristics to portions of a website, and using those characteristics to personalize presentation of the website by according to personas of visitors. Persona characteristics can represent any distinguishing feature of interest, including for example, gender, marital status, occupation, interests, race, hobbies, business interests, religious interests, etc. In preferred embodiments a service company handles the creation and maintenance of visitors' personas. The company stores relevant information on the computers of users, and then cooperates with the website operator to access that stored information as needed. In a particularly preferred embodiment personalization can be used to assist in deciding what advertisements to display or not display on a website.

Owner:ROBERT D FISH TRUST

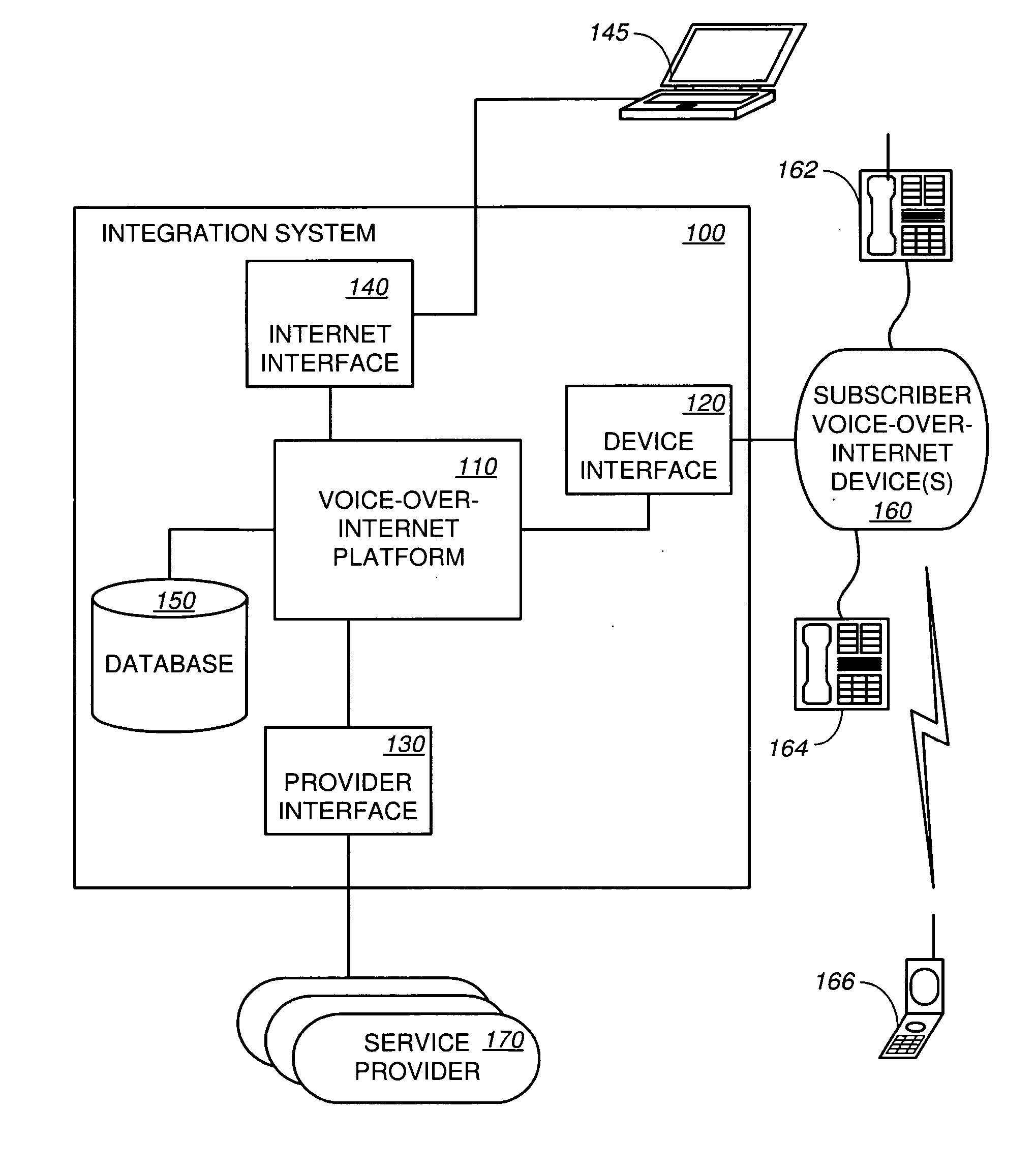

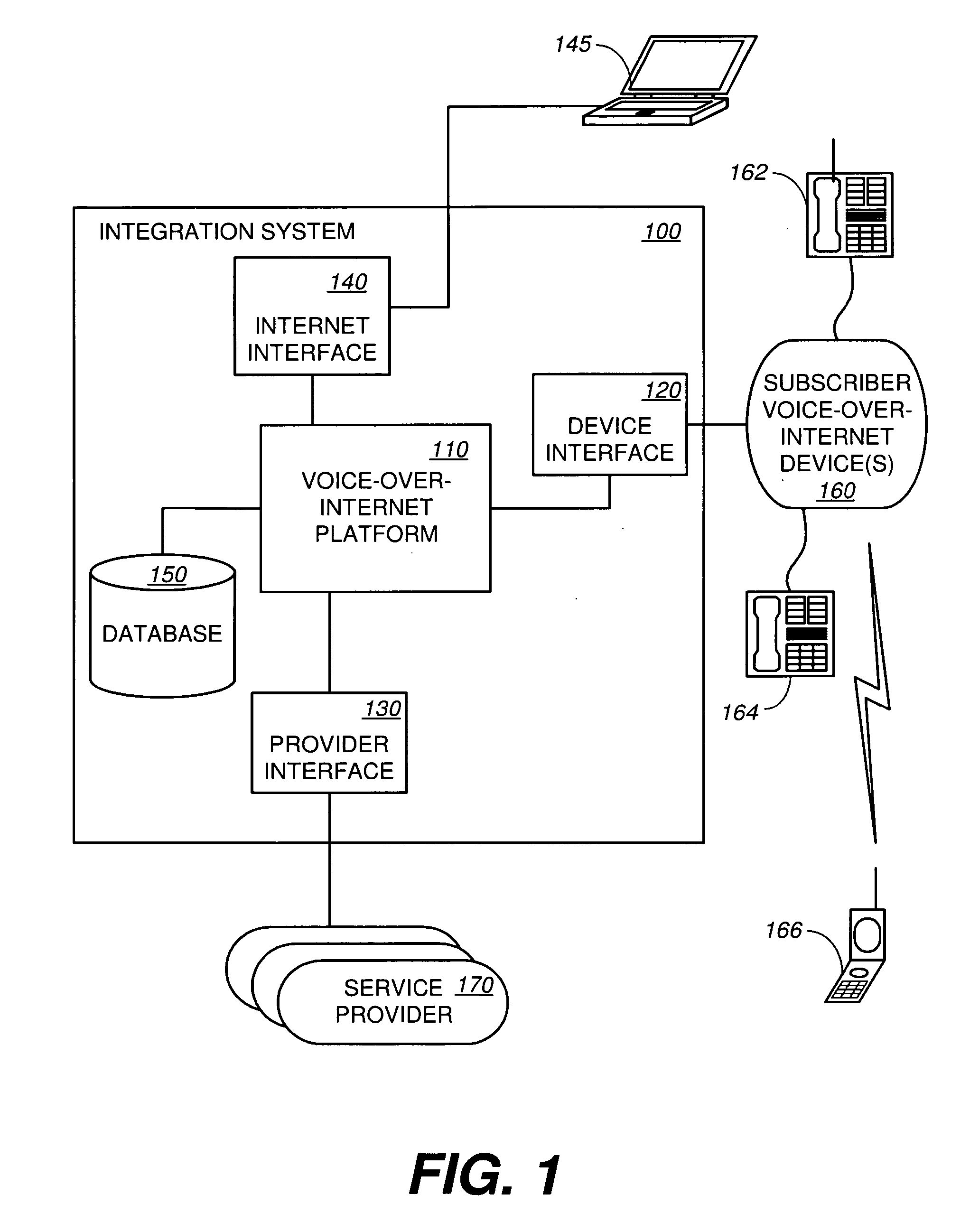

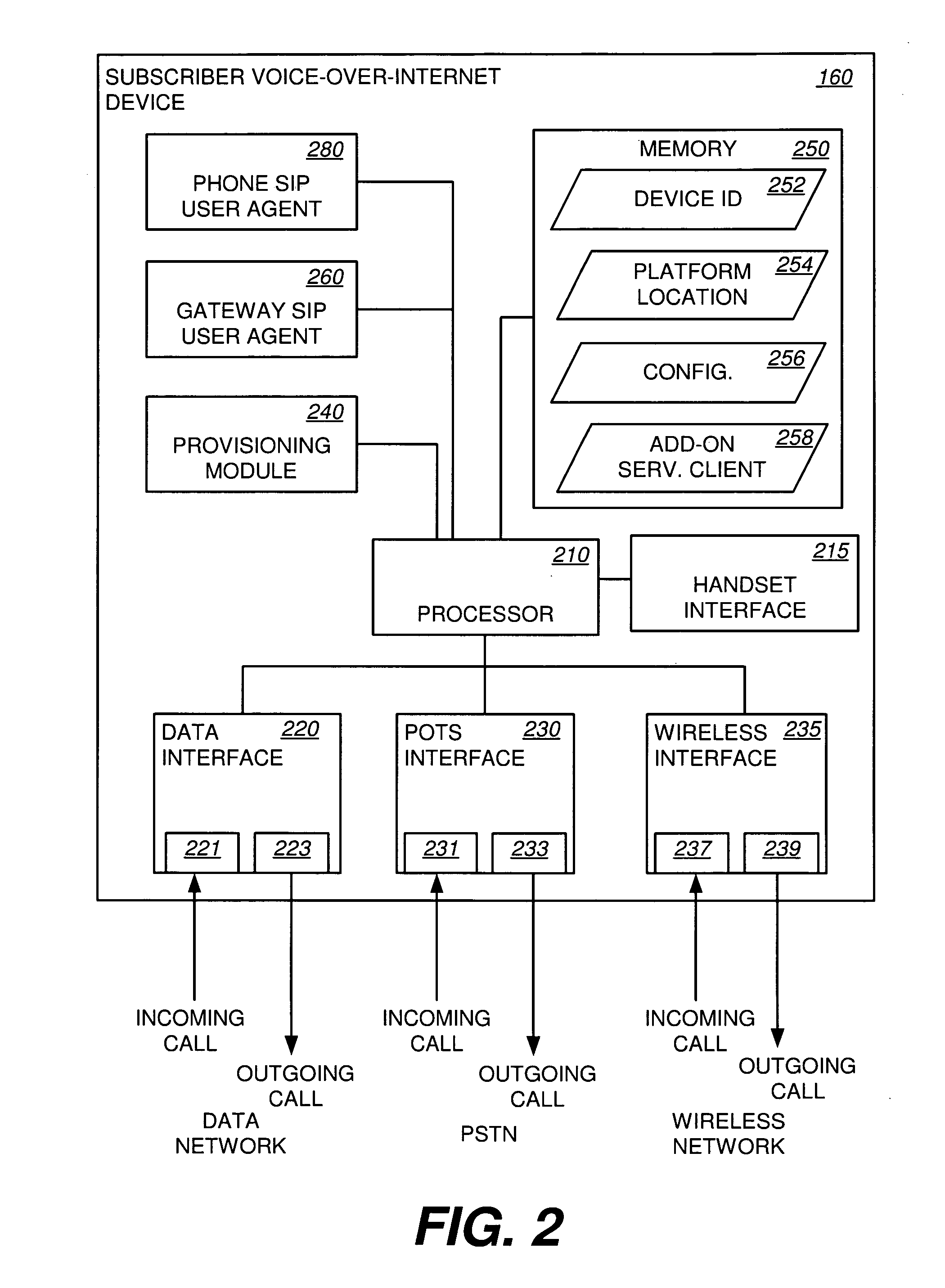

Integrating telephonic service subscribers

InactiveUS20070058613A1Interconnection arrangementsNetwork connectionsInternet radio deviceTTEthernet

A telecommunication system comprises a first interface, a second interface, and a voice-over-Internet device. The first interface enables a telephonic handset coupled to the voice-over-Internet device to communicate via a phone service. The second interface enables the telephonic handset to communicate via a data network coupled to the voice-over-Internet device. The voice-over-Internet device is configured to modify the phone service. The voice-over-Internet device exposes services provided over the data network to service subscribers. As a result, a mobile or wired telephone service customer can subscribe to add-on services provided by a service provider over the data network without the knowledge or permission of the existing telephone service company.

Owner:TELEVOLUTION

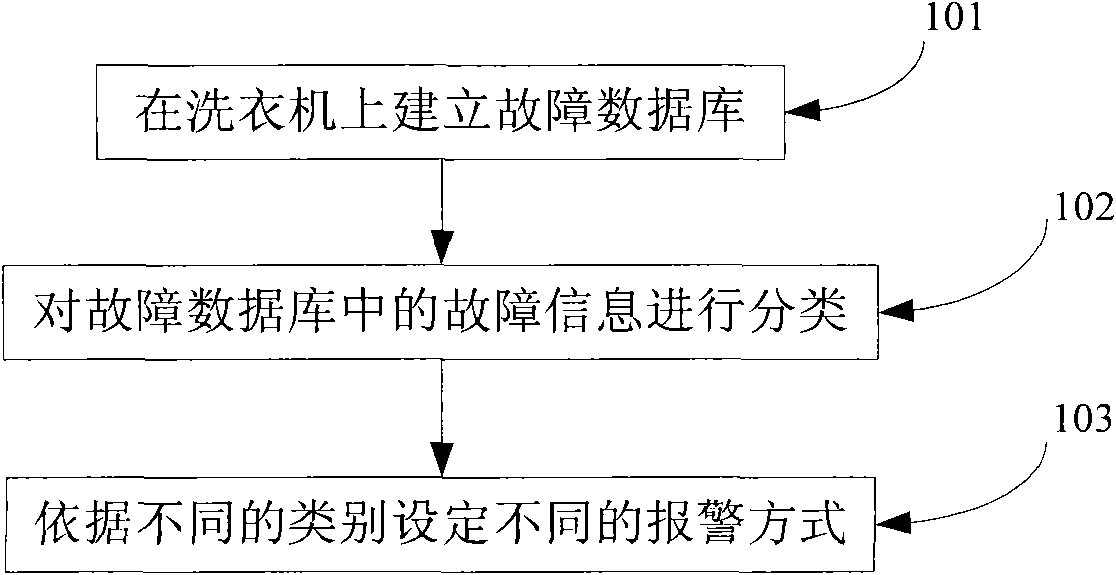

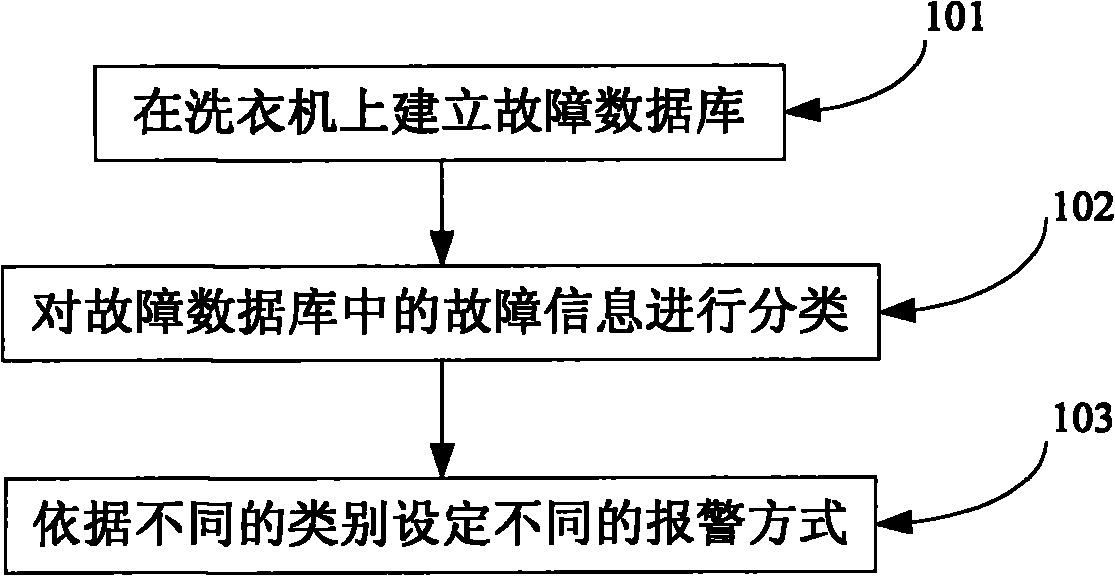

Method for automatically classifying feedback fault information of washing machine through internet of things

InactiveCN102123162AEasy maintenanceShorten the timeTransmissionSpecial data processing applicationsInformation typeTime efficient

The invention discloses a method for automatically classifying feedback fault information of a washing machine through internet of things, and relates to the field of washing machines. The method comprises the following steps of: 1, establishing a fault database on the washing machine; 2, classifying fault information in the fault database; and 3, setting different alarm modes according to different information types. In the scheme, the fault information of the washing machine is classified, namely the information of faults which can be handled by a user is classified into a category, and the information of the faults which are required to be maintained by an after-service company is classified into one category; and actual maintenance methods of corresponding faults are provided for the user, so that some simple faults can be maintained by the user to save time and cost. For the faults which are required to be maintained by the after-service company, corresponding fault information and handling modes are provided through the internet of things, so that the washing machine of the user can be maintained pertinently by the after-service company, and the problems that corresponding maintenance components are not carried in the face of a failed washing machine and the like are solved.

Owner:QINGDAO HAIER WASHING MASCH CO LTD

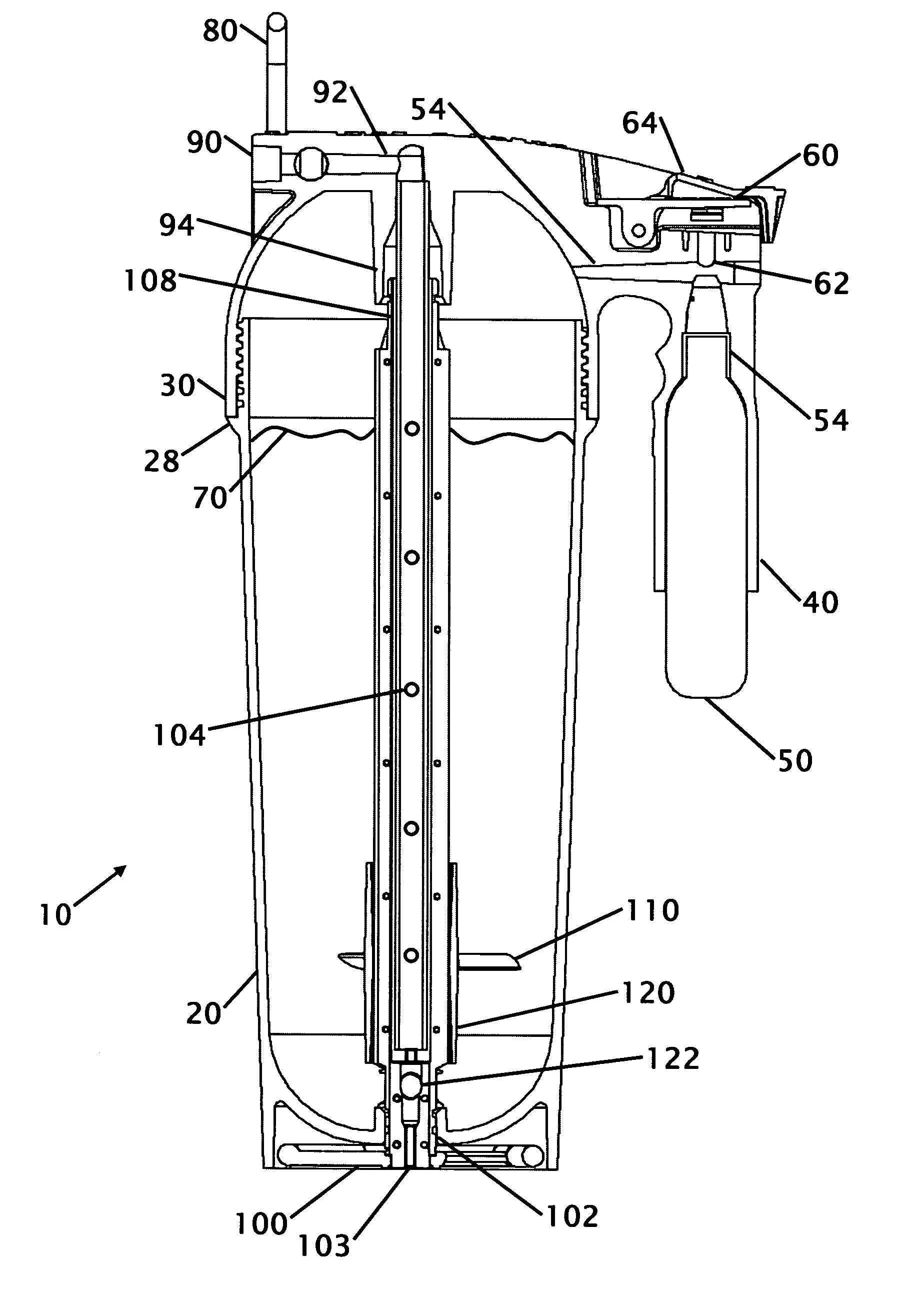

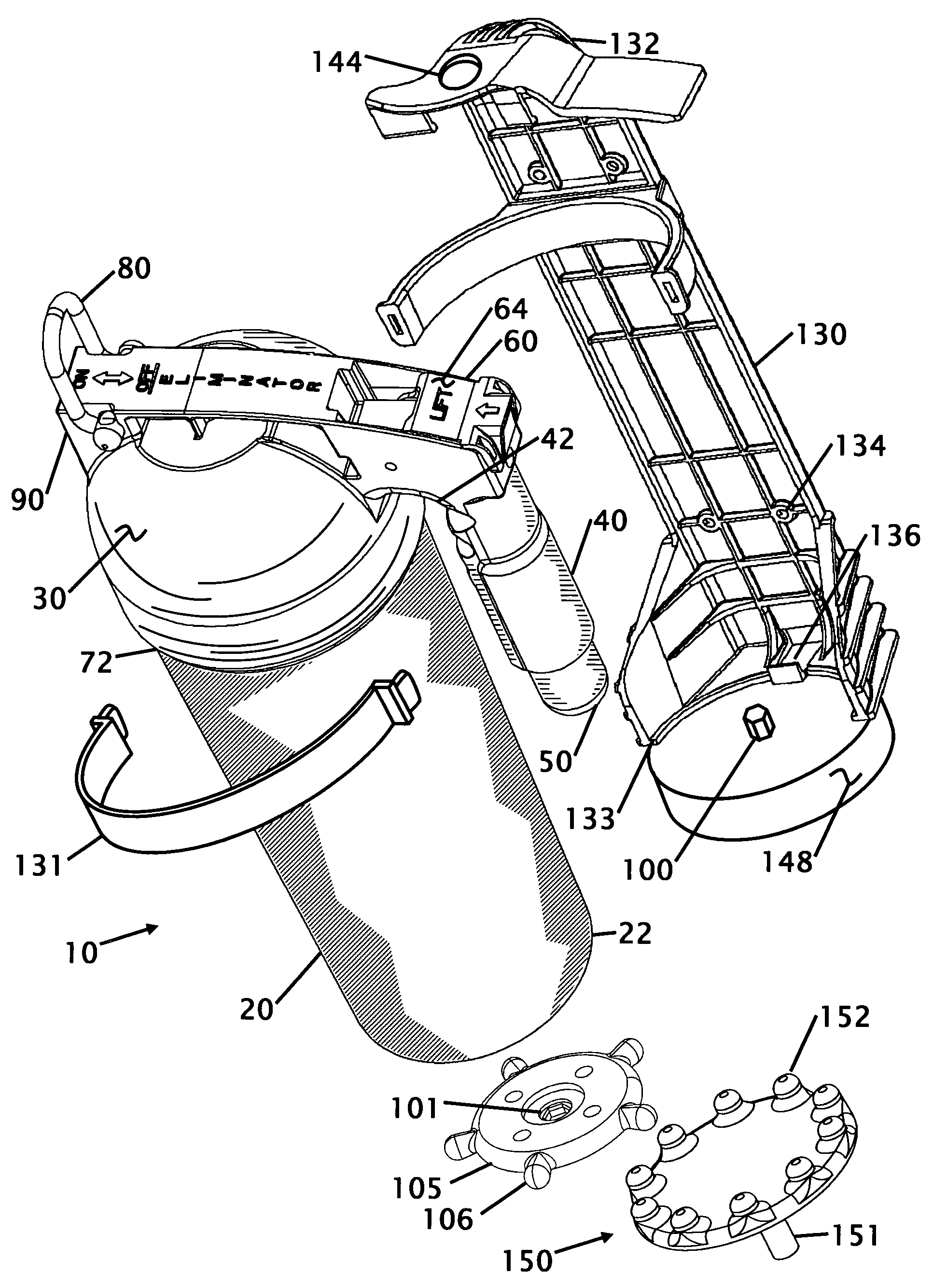

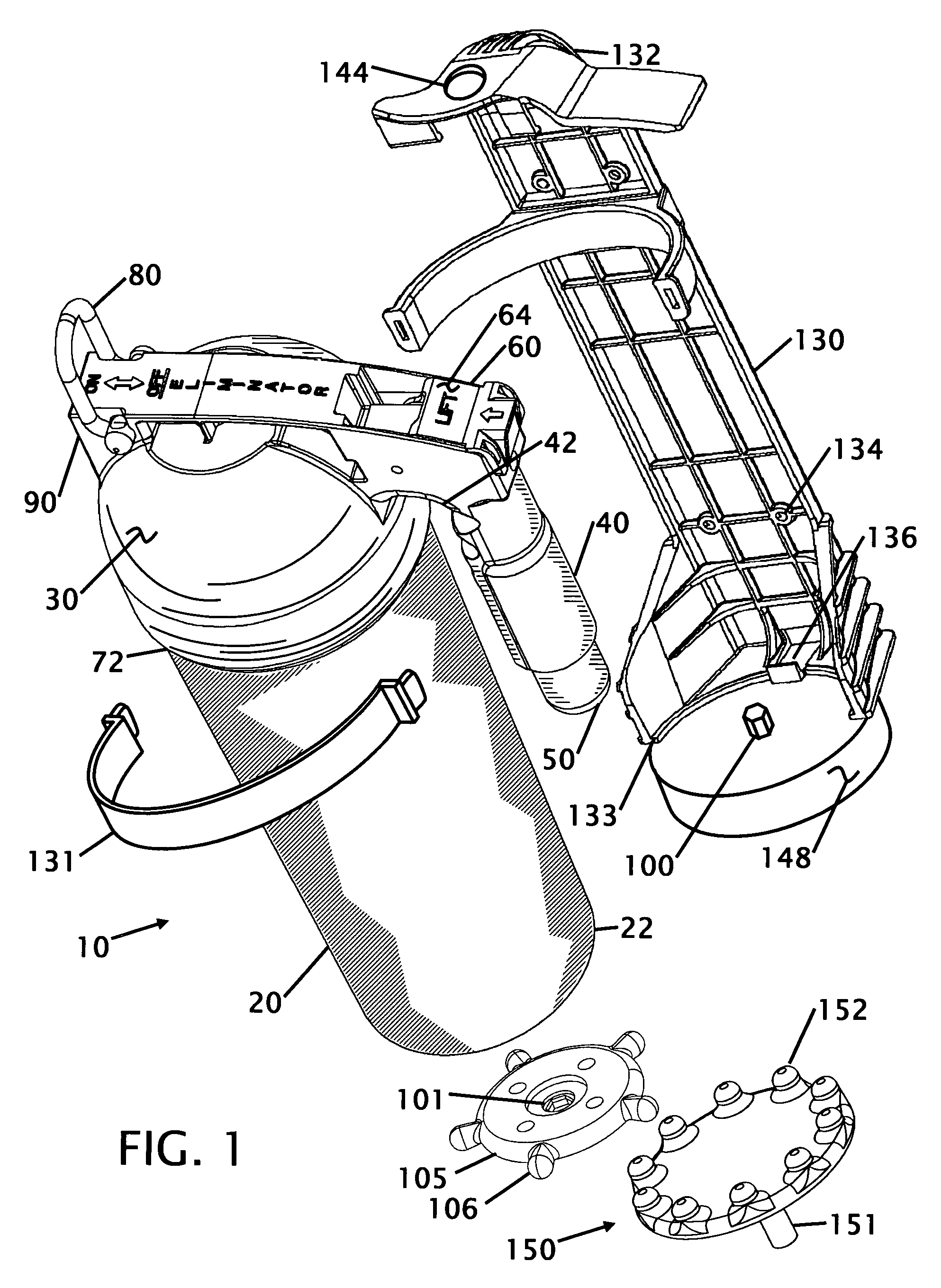

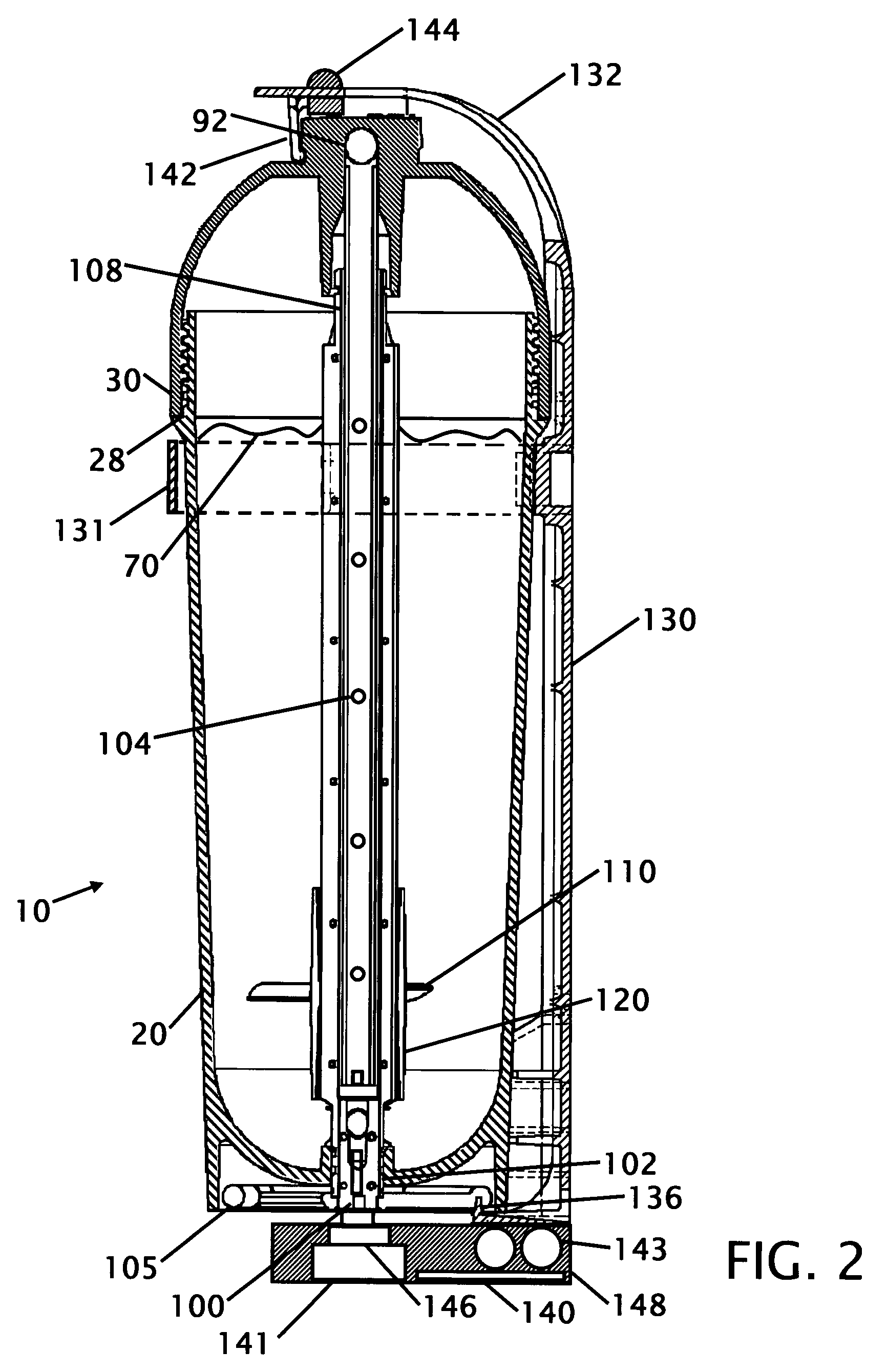

Self servicing fire extinguisher with external operated internal mixing with wide mouth and external pressurized canister

ActiveUS7318484B2High level of serviceReduce eliminateShaking/oscillating/vibrating mixersDispensing apparatusThird partyWide mouth

Improvements to a portable fire extinguisher where the improvements relate to a system where the owner of the extinguisher can service and maintain their fire protection. Systems in place today require the servicing of a third party. The service companies (third parties) are charged with maintaining the system. Further Improvements include an anti-bridging mechanism that is articulated from the exterior of the chamber to fluff, mix or stir the powder within the chamber to keep it in a liquefied state. An external pressurized canister allows easier servicing or replacement of the pressurized canister as well as the ability to maintain the chamber in an un-pressurized condition, allowing non-HASMAT shipping. These features extend the service intervals while maintaining the fire extinguisher in a ready condition. The fire extinguisher is construction of components that are interchangeable and provide equal operation for left and right handed people.

Owner:RUSOH INC

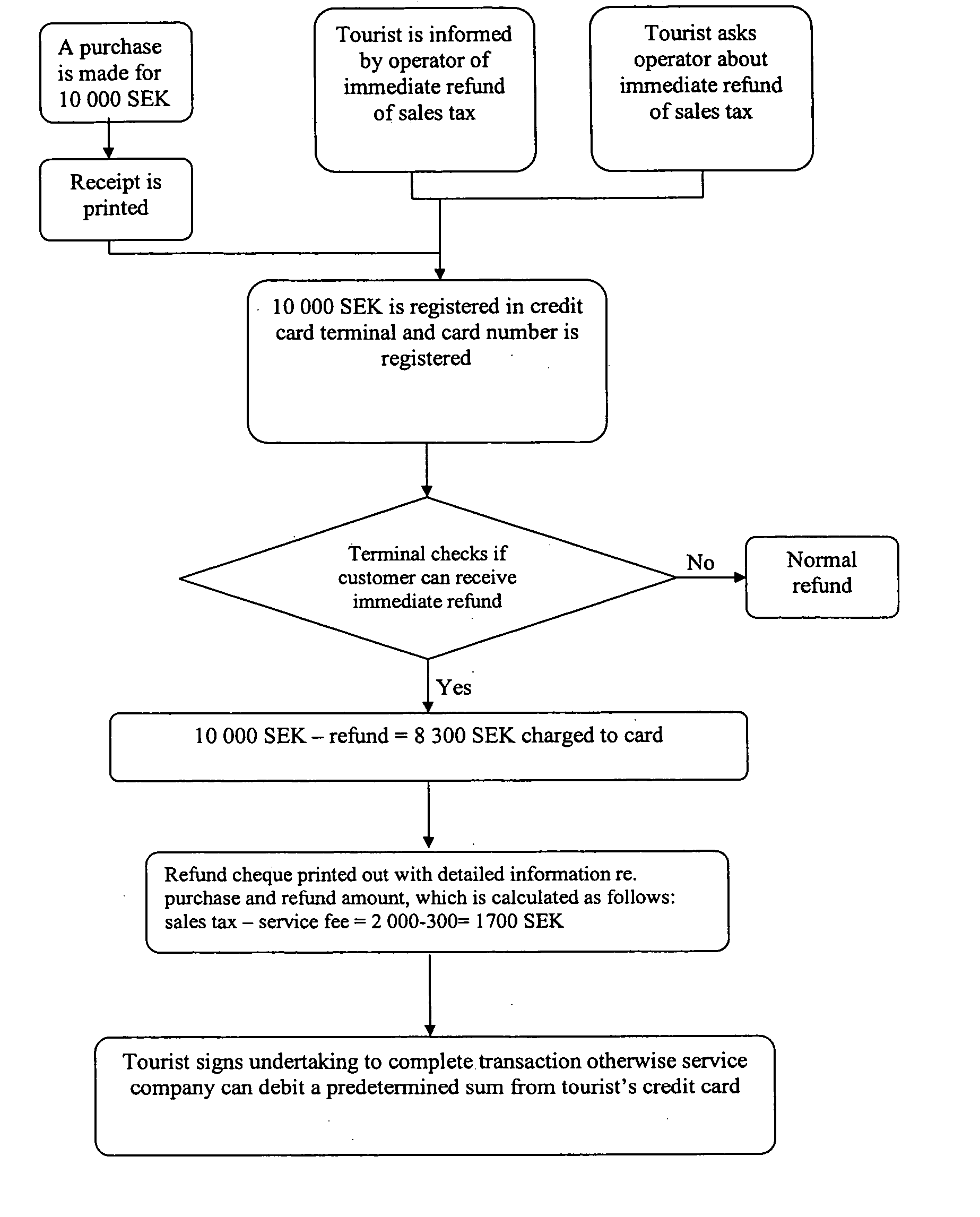

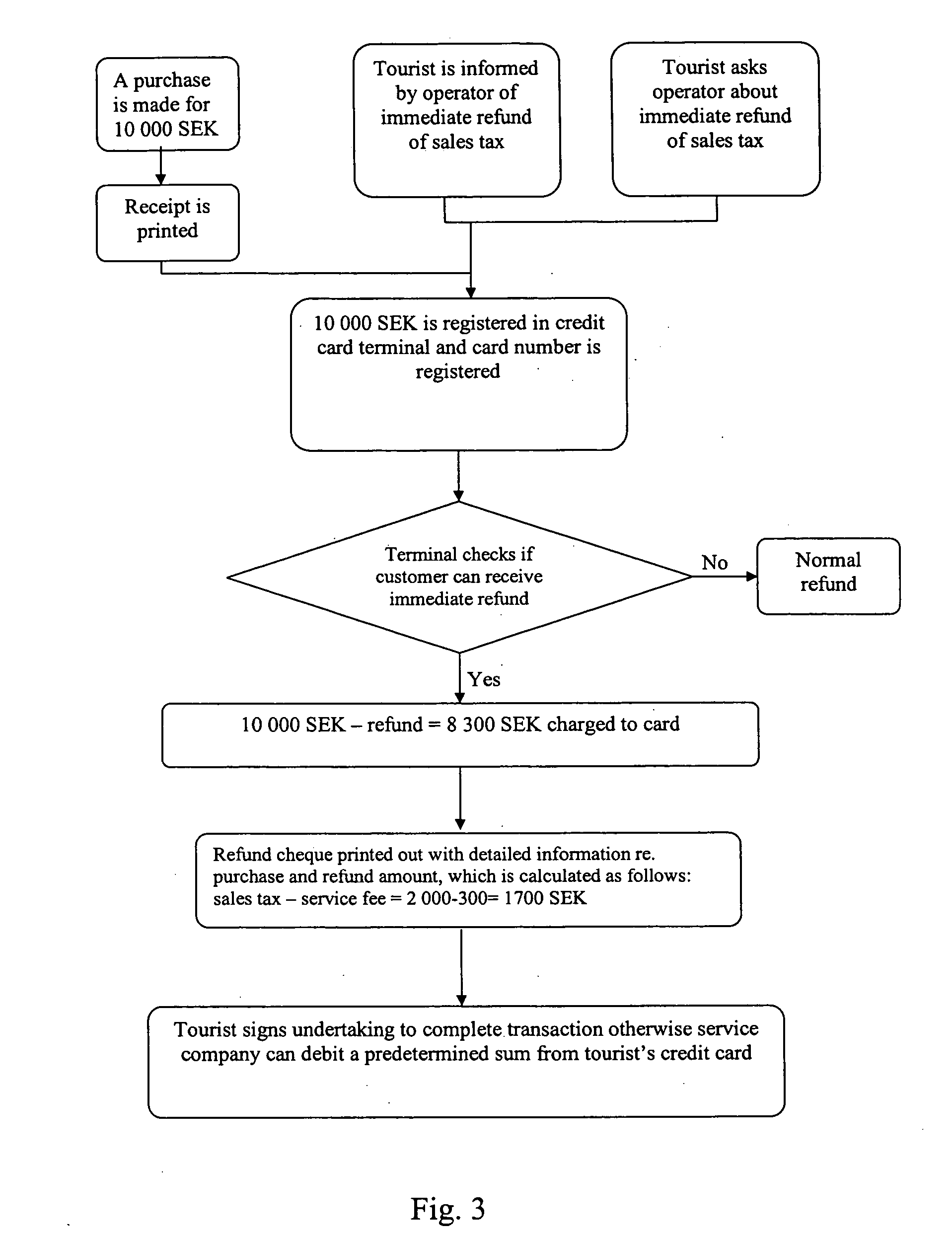

System for handling refunding of value-added tax

InactiveUS20050096989A1Improve liquidityFinanceBuying/selling/leasing transactionsCredit cardOperating system

System for handling refunding of sales tax. The system comprises shop terminals (1,2,3) with credit card readers for purchase transactions via consumer's credit cards. The shop terminals (1,2,3) have means for input of purchase data and the system has programs for adding data generated by the system to purchase data. The shops have printers for purchase receipts and refund forms and said program controls printout of refund forms comprising detailed information about the purchase and corresponding refund of sales tax. The consumer's credit card number is registered in connection with the purchase and said program is arranged to check via the credit card number the consumers entitlement to refund of sales tax. Said program controls the debiting of the credit card and when the consumer is entitled to a refund of sales tax the credit card is debited with the total purchase amount minus an amount which is value-added tax minus a service fee. The program controls printout of a declaration, to be signed by the consumer, that he will carry out export of goods, have refund forms customs-stamped and ensure that stamped refund forms are delivered to a service company, which checks the customs-stamped refund form and returns the form to the shop, which in turn sends a list of purchases performed via the shop with entitlement to refund of sales tax to the tax authority of the country and receives a refund of sales tax from the authority. Said declaration includes information that the consumer agrees to a pre-determined amount being debited from the consumers credit card if the goods are not exported and said measures with the refund form are not performed.

Owner:GLOBAL BLUE HLDG AB

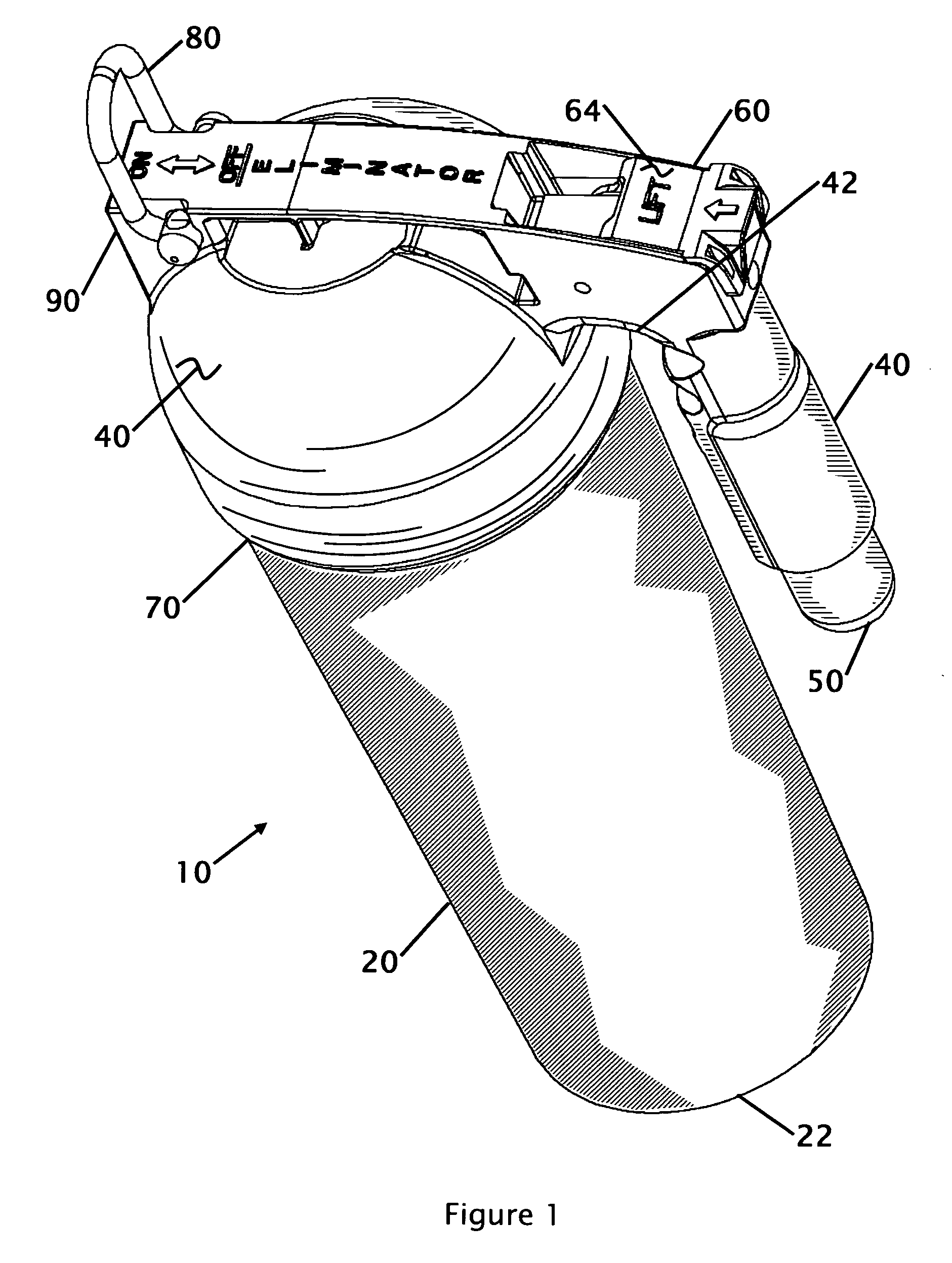

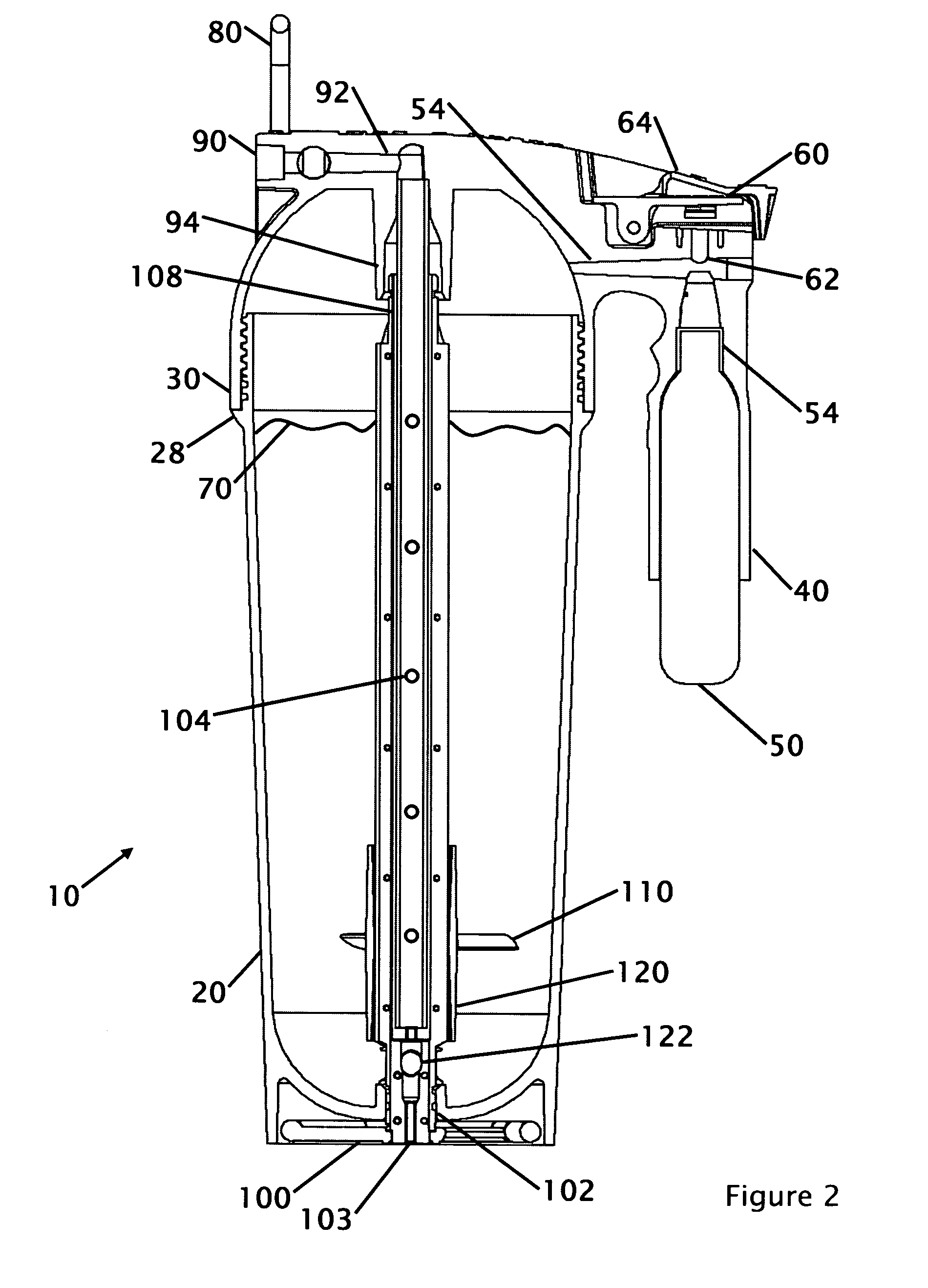

Self servicing fire extinguisher with wall mounting bracket and powder fluffing apparatus

ActiveUS7650948B2High level of serviceReduce eliminateShaking/oscillating/vibrating mixersDispensing apparatusThird partyFire extinguisher

Improvements to a portable fire extinguisher where the improvements relate to a system where the owner of the extinguisher can service and maintain their fire protection. Systems in place today require the servicing of a third party. The service companies (third parties) are charged with maintaining the system. Further Improvements include an anti-bridging mechanism that is articulated from the exterior of the chamber to fluff, mix or stir the powder within the chamber to keep it in a liquefied state. The improvements further include a wall mounting bracket that reduces tampering with the extinguisher, an automatic fluffing motor and manual fluffing wheel with a chuck for use with a drill. These features extend the service intervals while maintaining the fire extinguisher in a ready condition. The fire extinguisher is construction of components that are interchangeable and provide equal operation for left and right handed people.

Owner:RUSOH INC

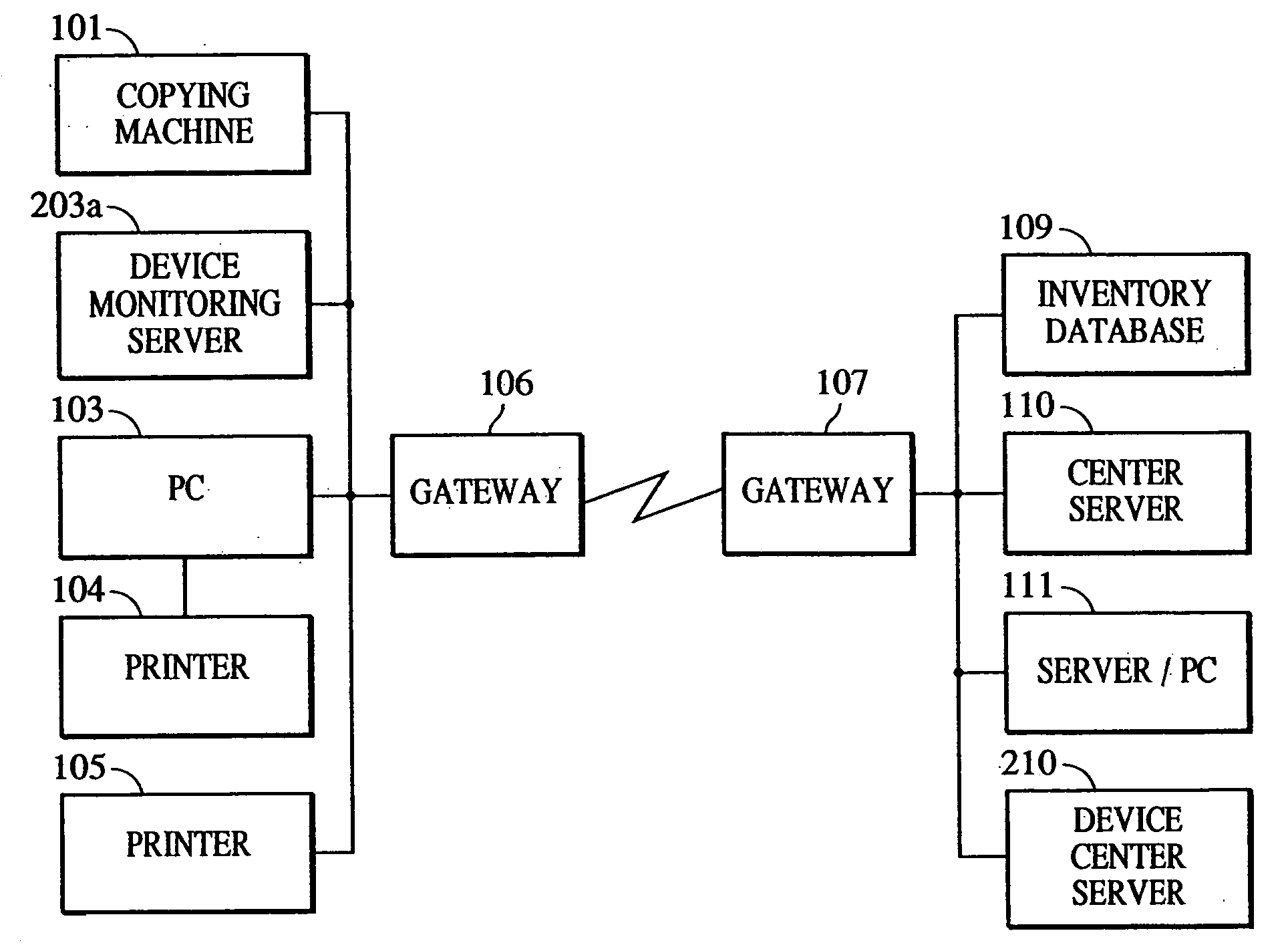

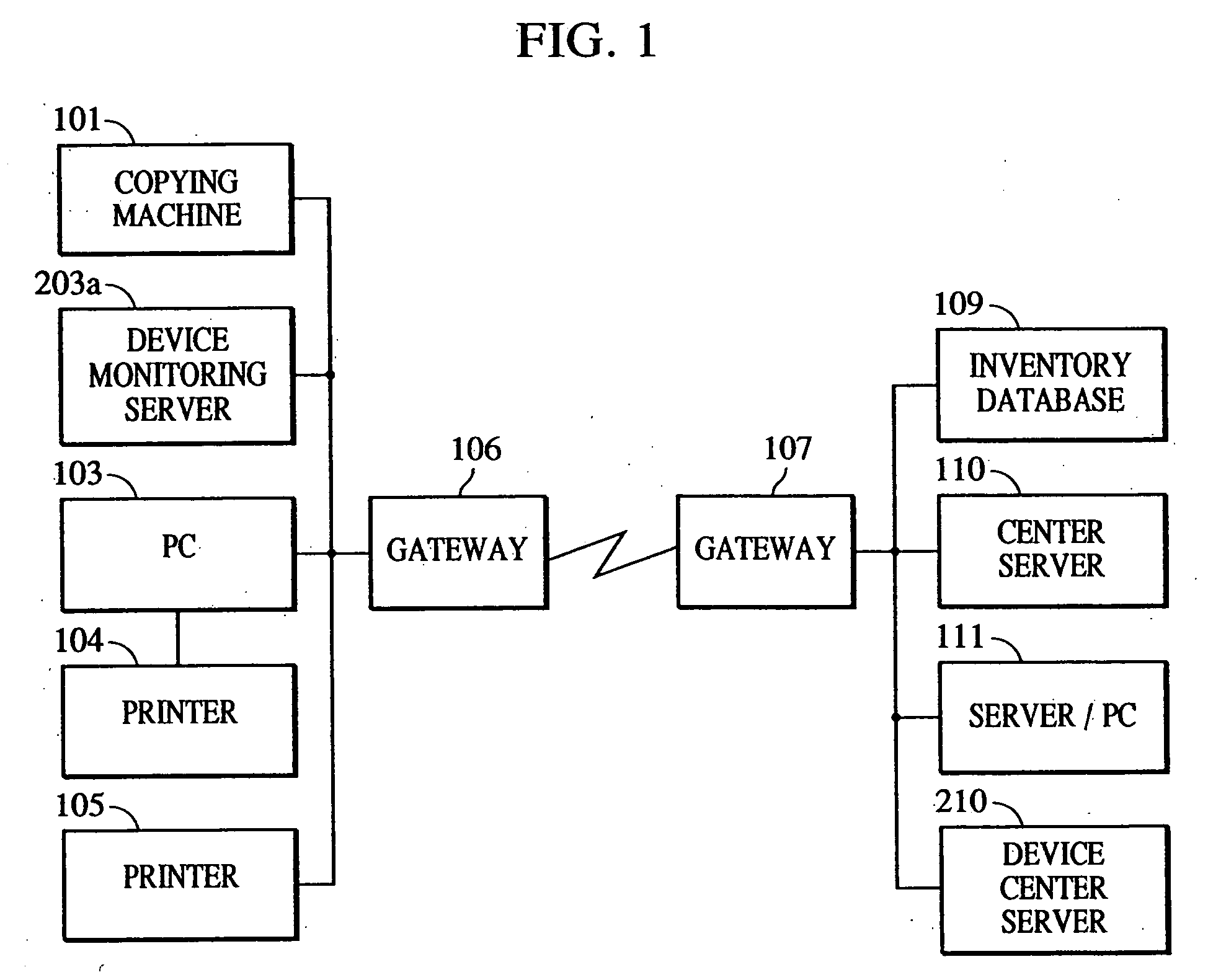

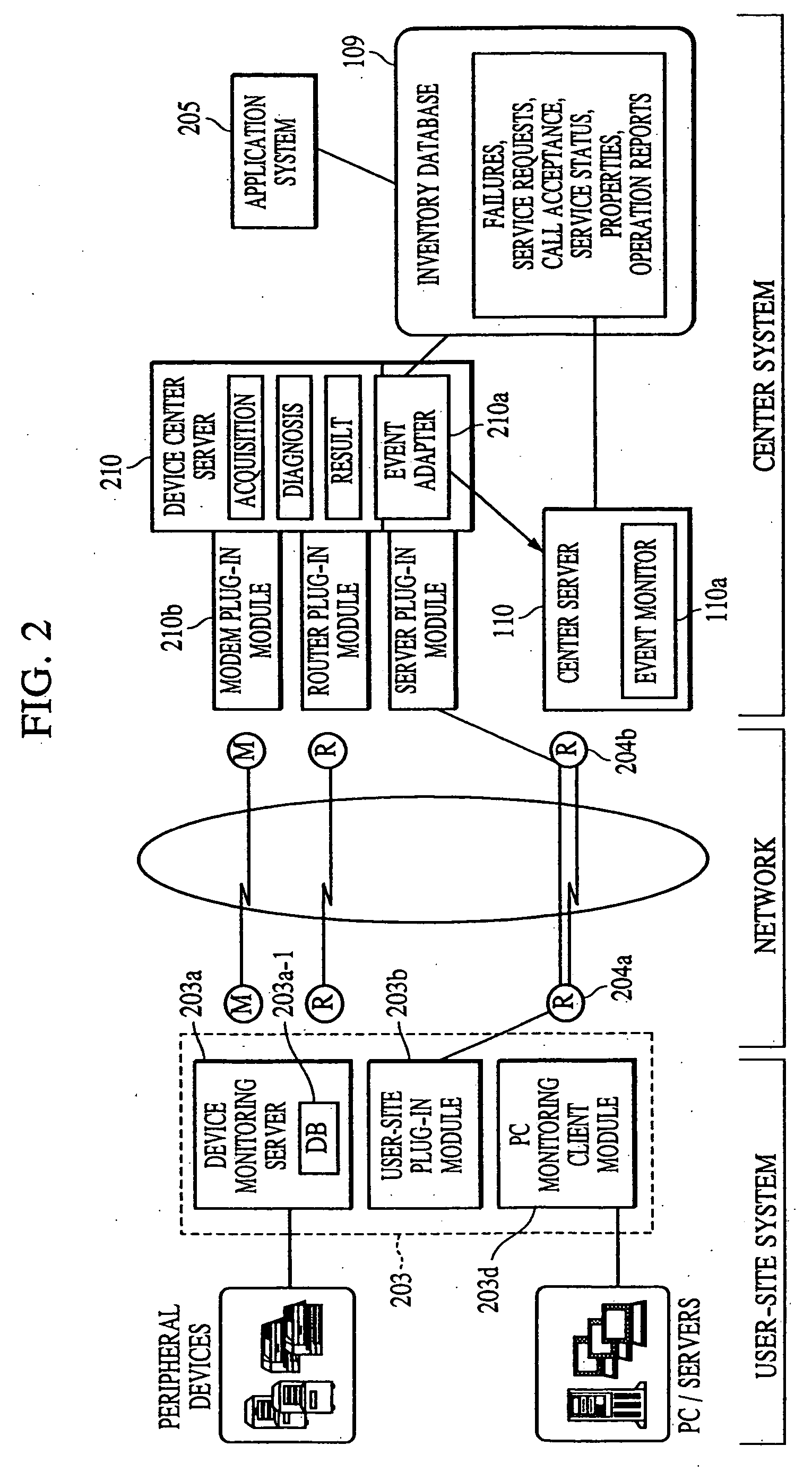

Apparatus for managing a device, program for managing a device, storage medium on which a program for managing a device is stored, and method of managing a device

InactiveUS20060107088A1Telemetry/telecontrol selection arrangementsError detection/correctionEngineeringManagement system

A remote site managing system manages, in a unified fashion, computers and peripheral devices installed at a customer site. The remote site managing system automatically receives information indicating a failure which has occurred or indicating a high possibility that a failure will occur in some of PC / servers or peripheral devices installed in a customer's office and provides maintenance services without causing a customer to be concerned about anything. Furthermore, transmission of a request to a maintenance service company and reception of a service operation report from the service company are performed by the remote site managing system in an unified fashion.

Owner:CANON KK

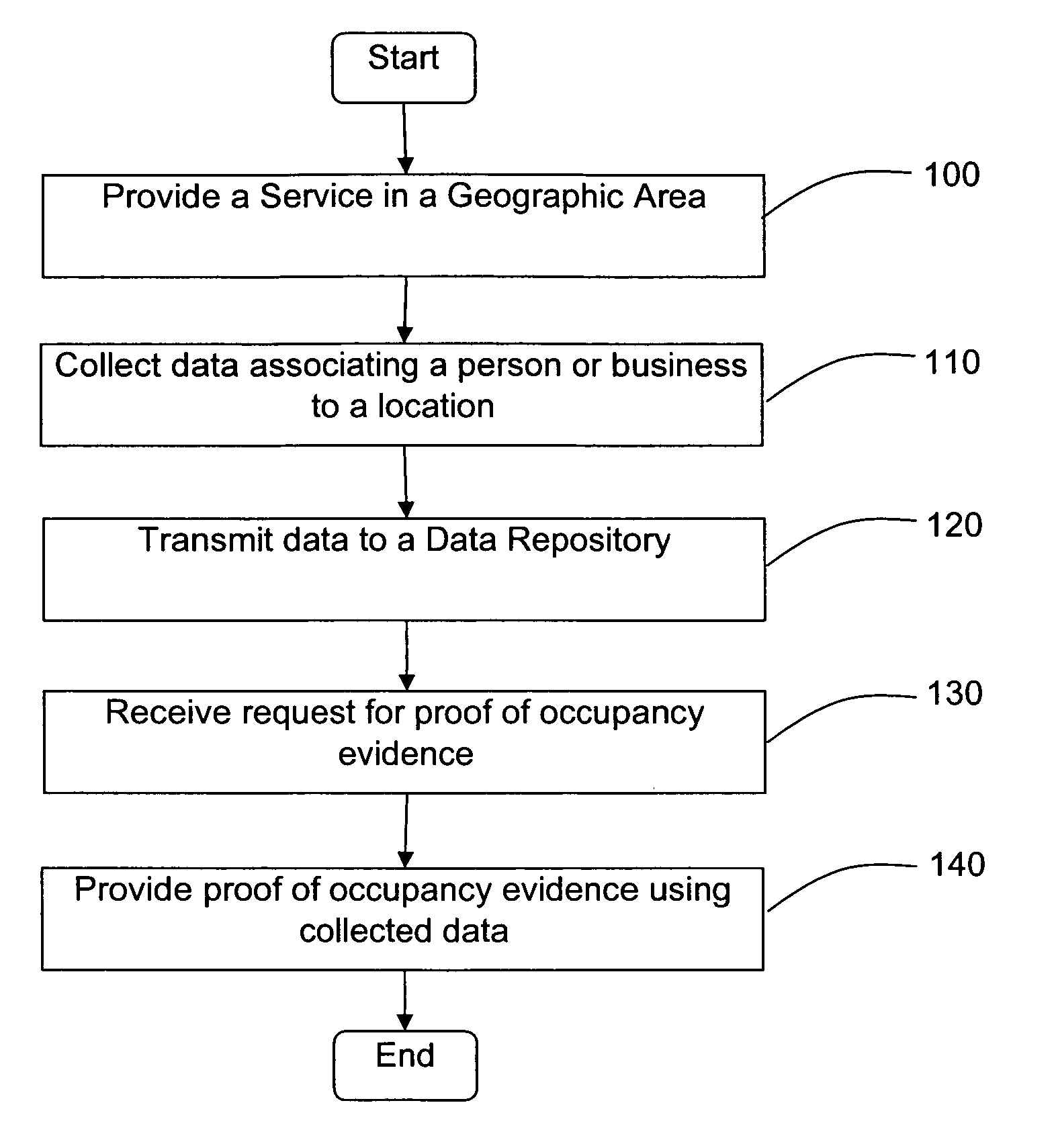

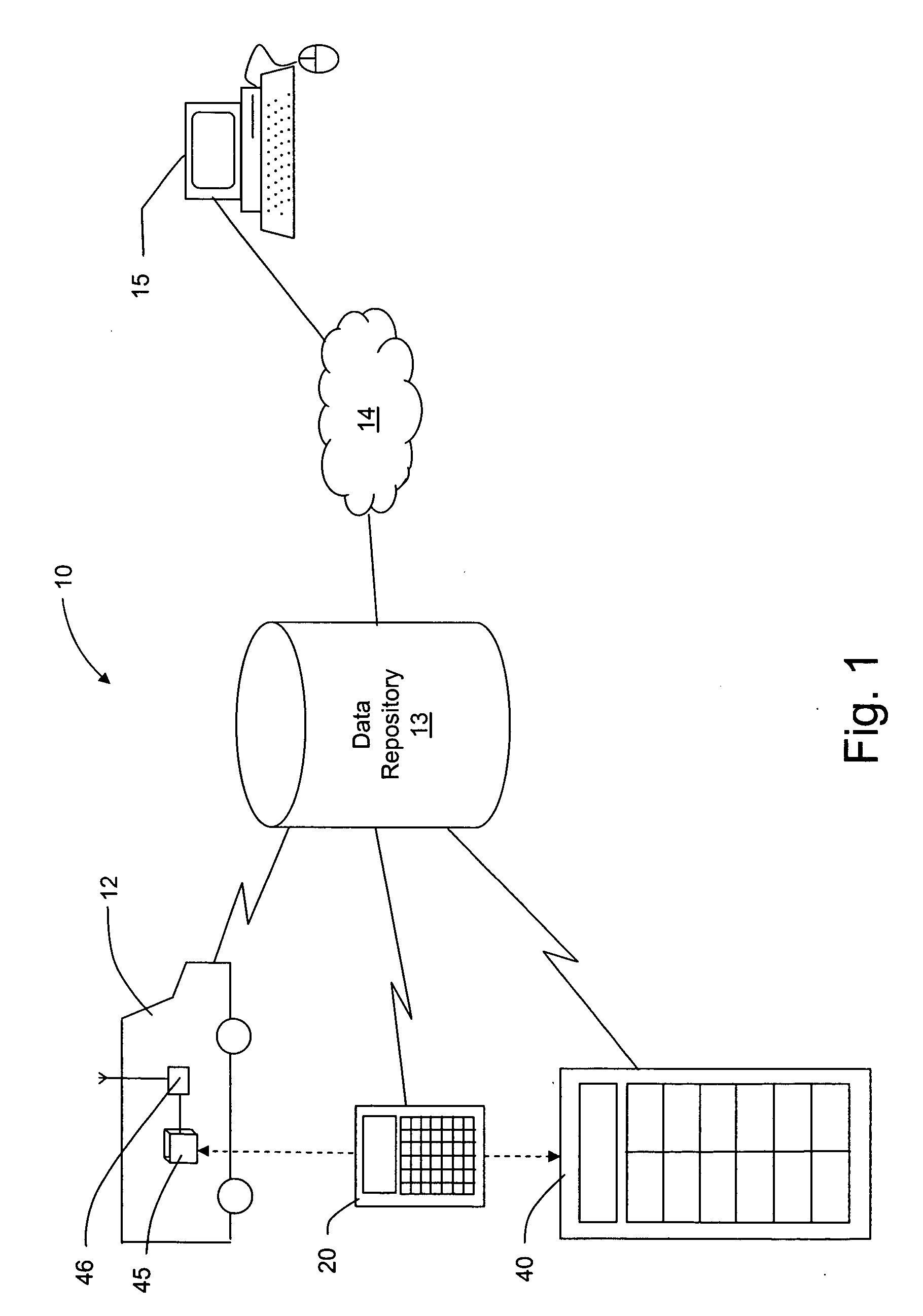

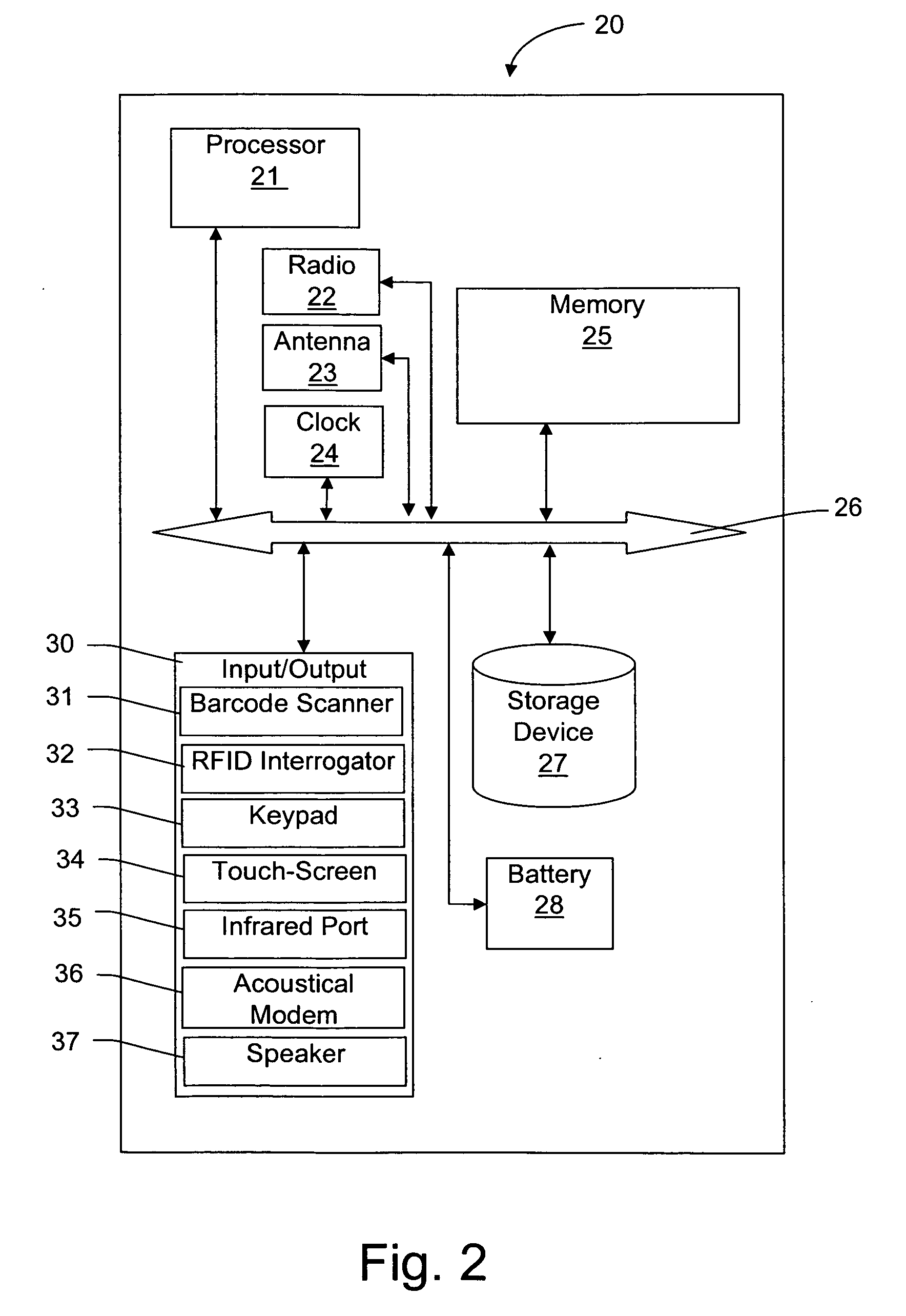

Method and system for gathering data

ActiveUS20070047459A1Cost-effectiveData processing applicationsError preventionOperating systemTime frame

Embodiments of the present invention seek to provide a cost effective means for gathering data which associates an individual or business with an address for a given time frame. This is accomplished by utilizing resources already providing a service in a geographic area to collect the desired data. In some embodiments, data collected in relation to a service company's regular course of business are made available for other purposes such as proof of occupancy. In other embodiments, service company representatives, in addition to their primary tasks, are dispatched to specific addresses to gather data unrelated to their primary tasks.

Owner:UNITED PARCEL SERVICE OF AMERICAN INC

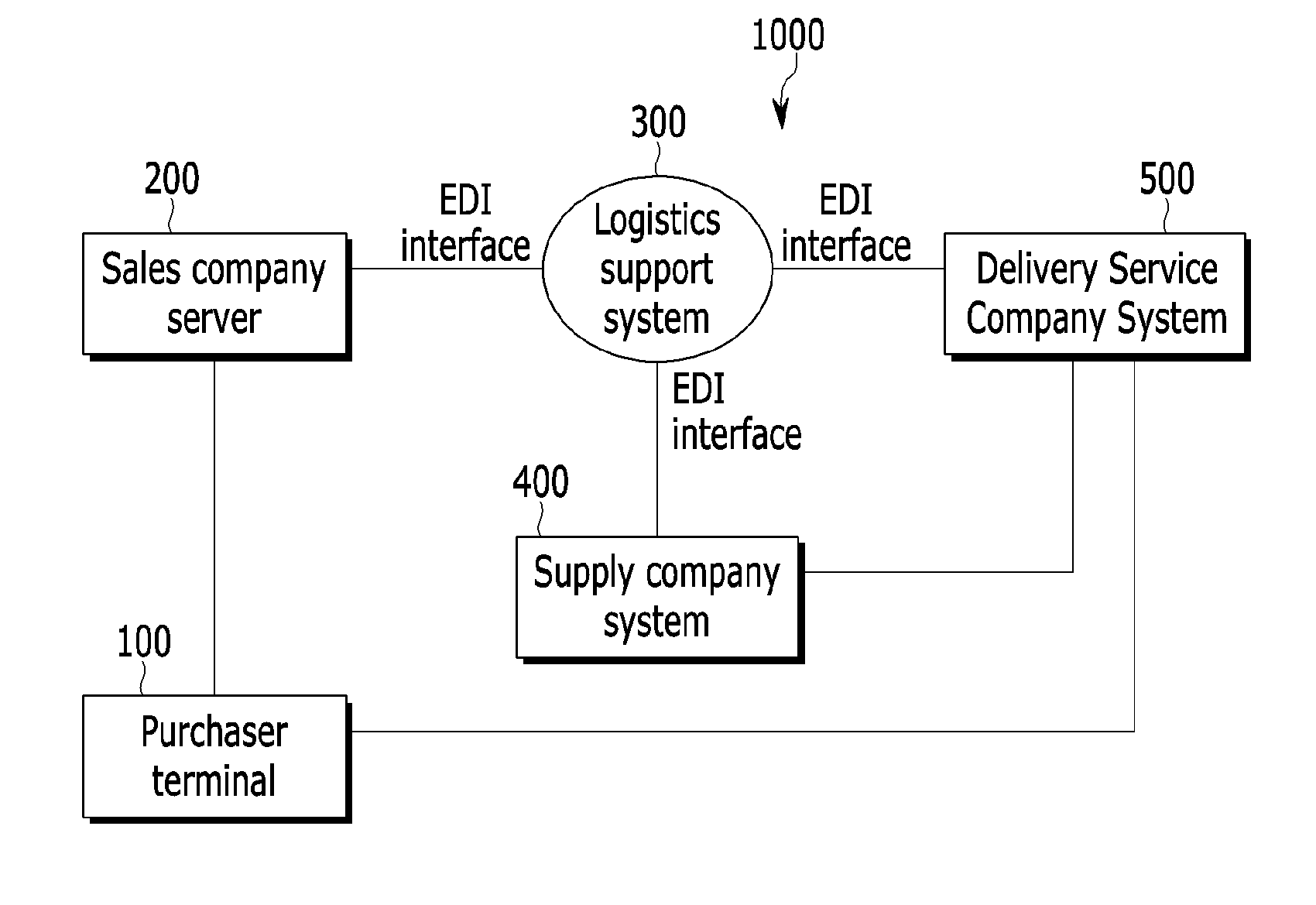

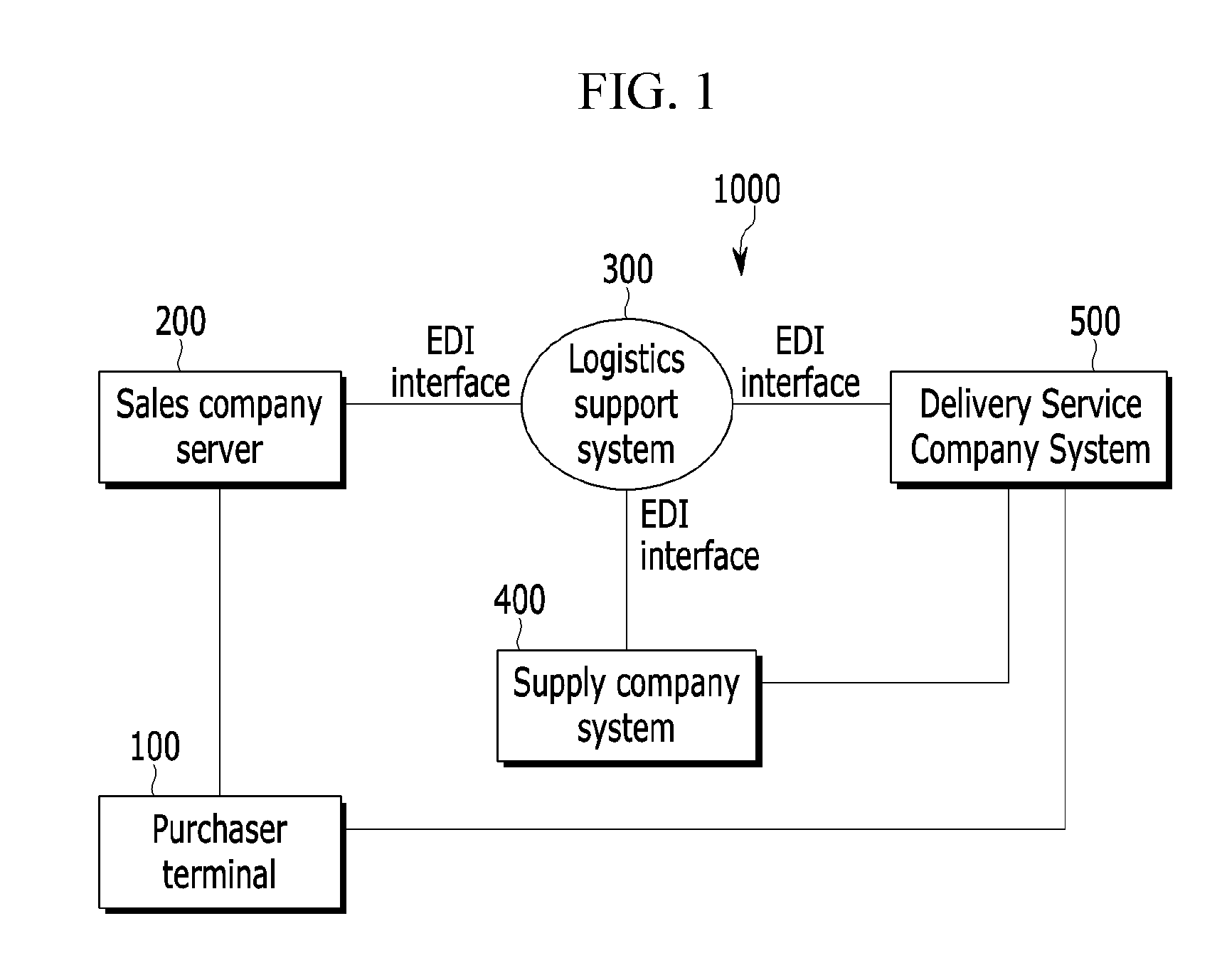

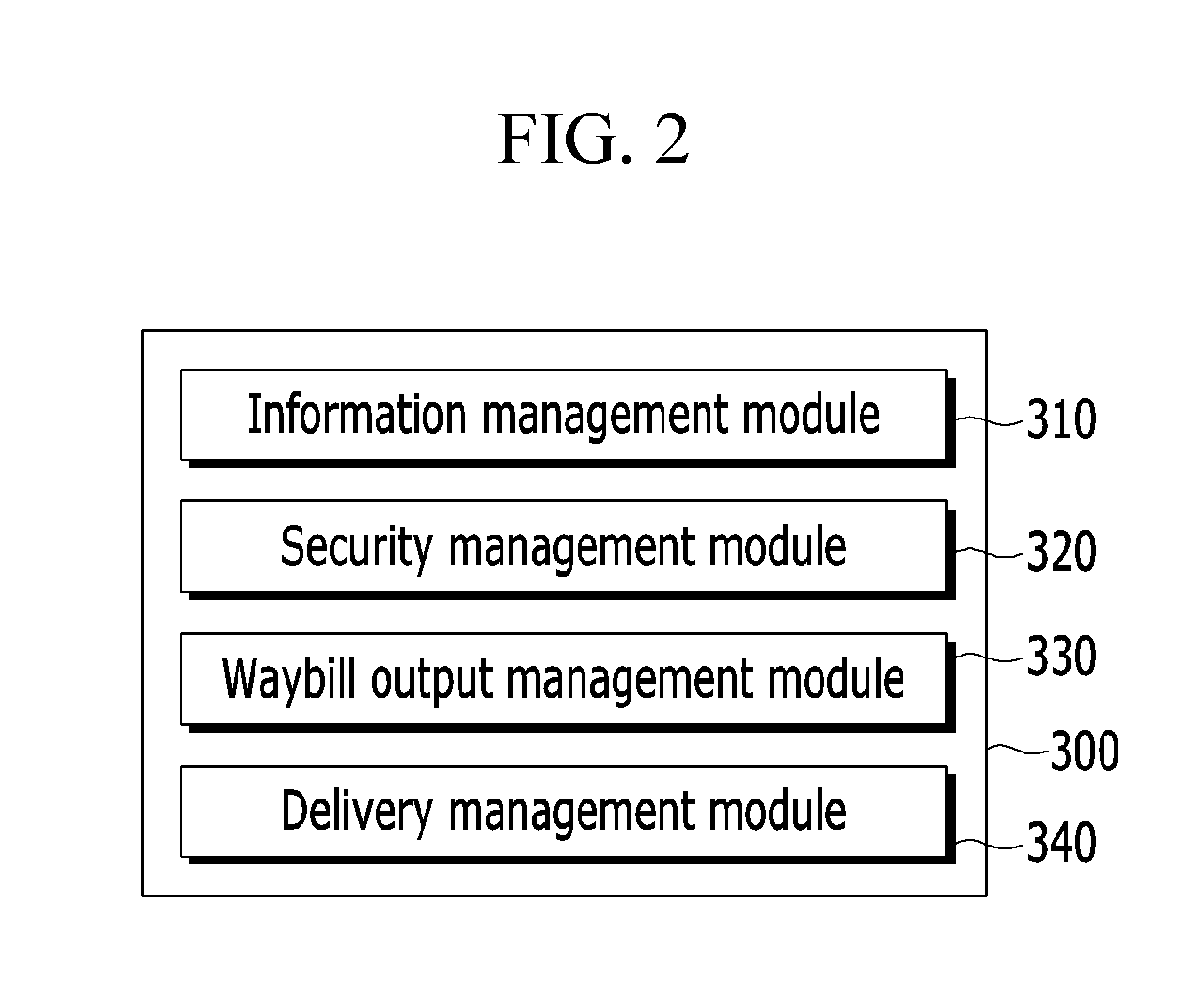

Logistics support method and system for online shopping

InactiveUS20130138536A1Reduce personal informationEasy to operateBilling/invoicingBuying/selling/leasing transactionsSupporting systemProduct order

A logistics support method of a logistics support system for supporting online shopping includes: receiving a usable range for a waybill number from at least one delivery service company system; receiving product order information, except for personal information, from a sales company server selling a product; receiving a request for waybill output information containing the product order information from a supply company system supplying the product or the delivery service company system delivering the product; receiving and encrypting the personal information corresponding to the product order information from the sales company server; generating the waybill output information containing the encrypted personal information, the product order information, and a waybill number belong to the usable waybill number range; and transmitting the waybill output information to the supply company system or the delivery service company system.

Owner:I CIUS

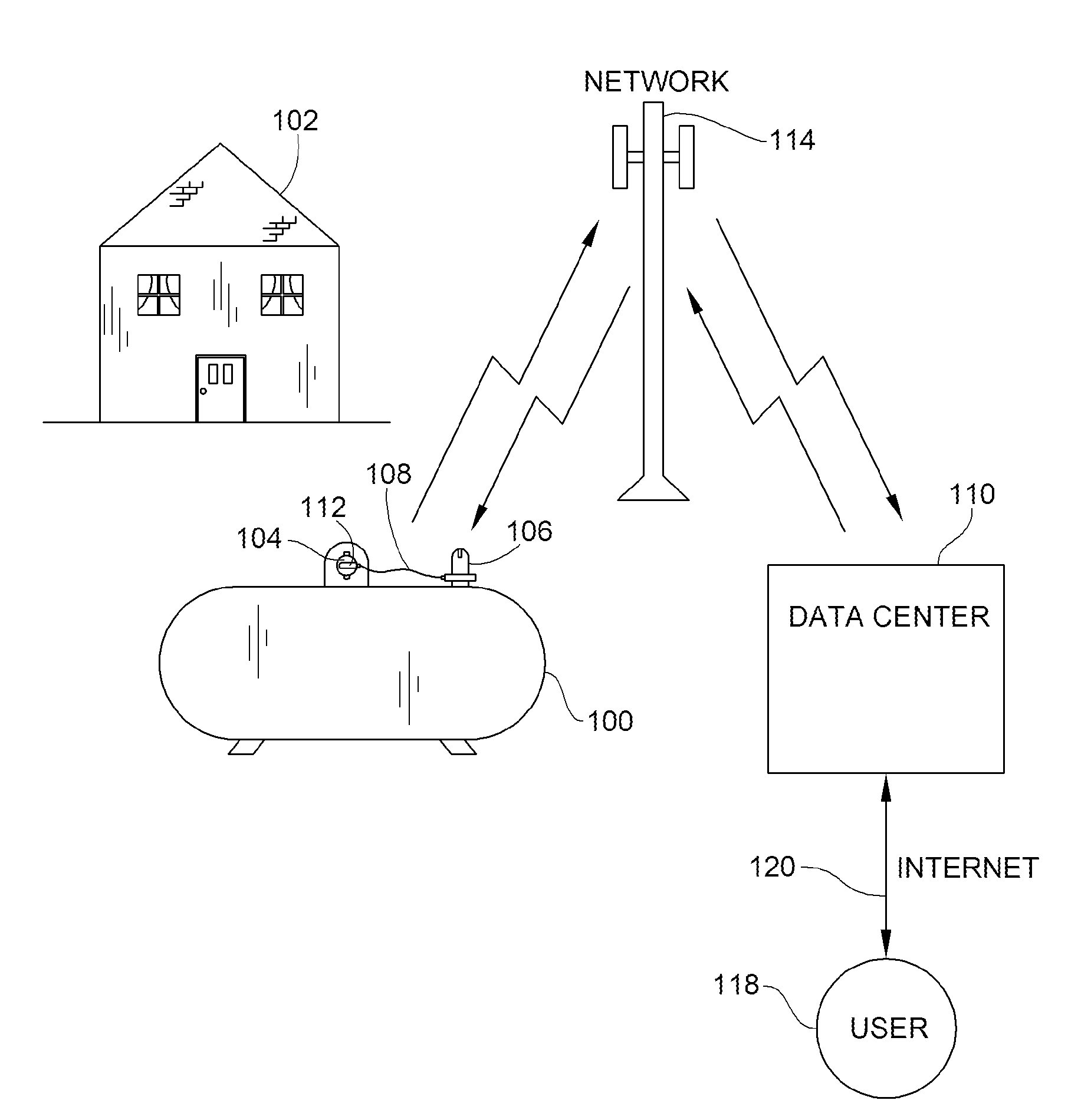

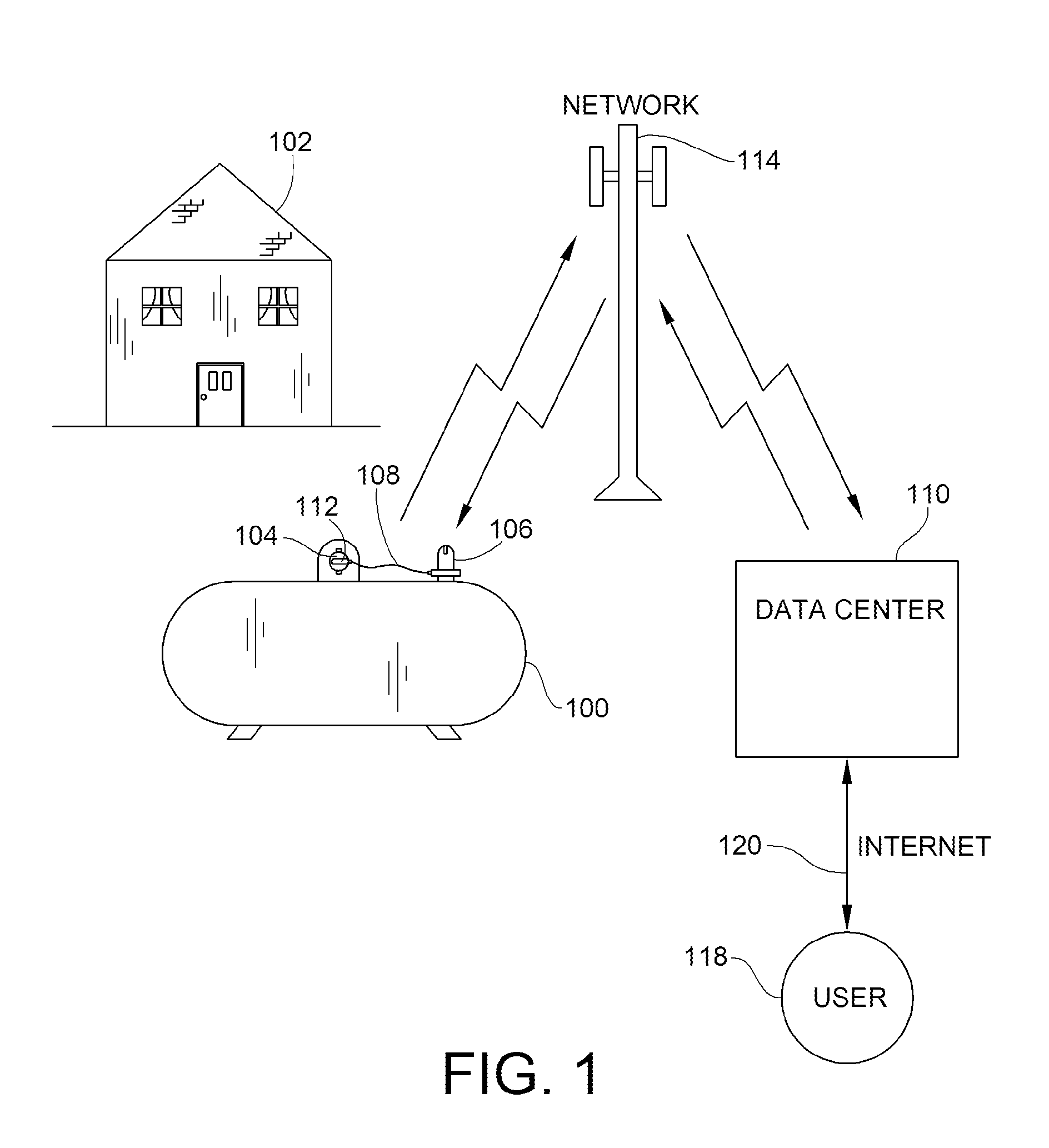

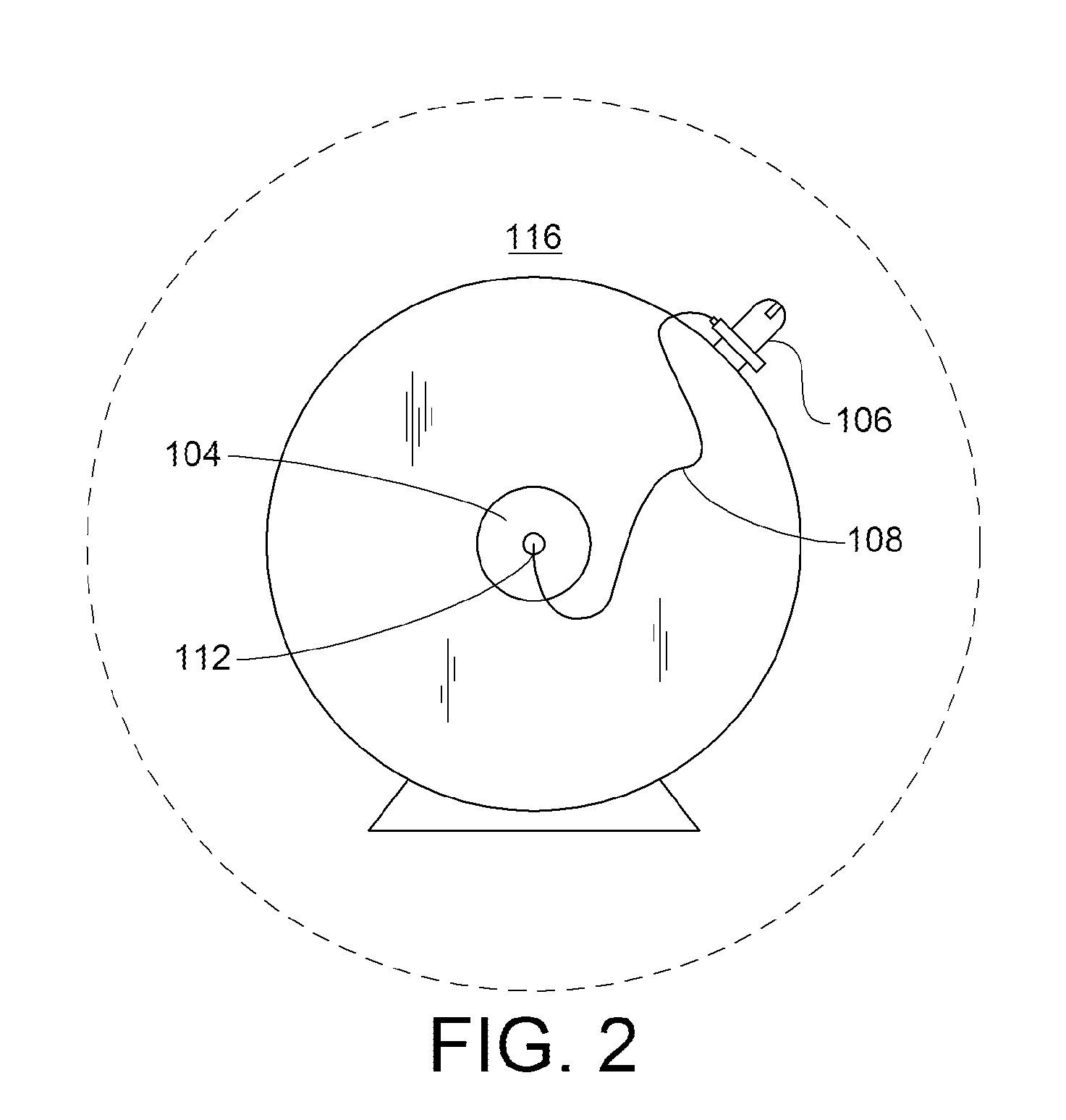

Intrinsically Safe Cellular Tank Monitor For Liquified Gas and Cryogenic Liquids

InactiveUS20090243863A1Eliminate useReduces system component costAlarmsLevel indicatorsIntrinsic safetyData center

An intrinsically safe cellular tank level monitor for use with consumer LP storage tanks is provided. The cellular monitor is adapted to read the LP storage tank gauge and transmit the level information through a cellular network to a data center. The data center may be part of or may communicate with a fuel delivery service company serving the residential consumer. The cellular monitor is a smart device that allows two-way communication over the cellular network. Control logic within the cellular monitor controls transmission of data to the data center as well as the determination and transmission of alarm conditions as determined by the local cellular monitor.

Owner:INVENSYS SYST INC

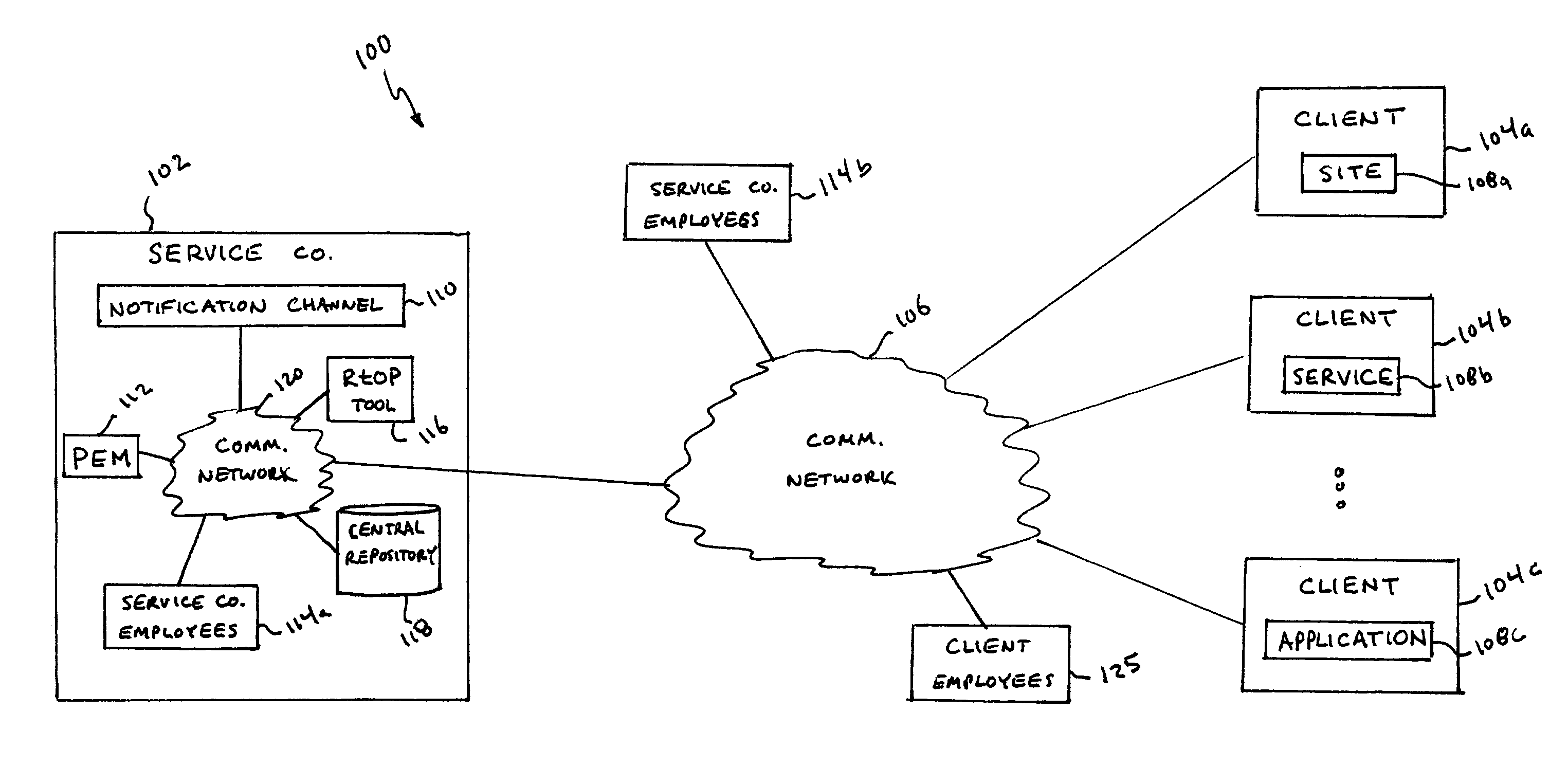

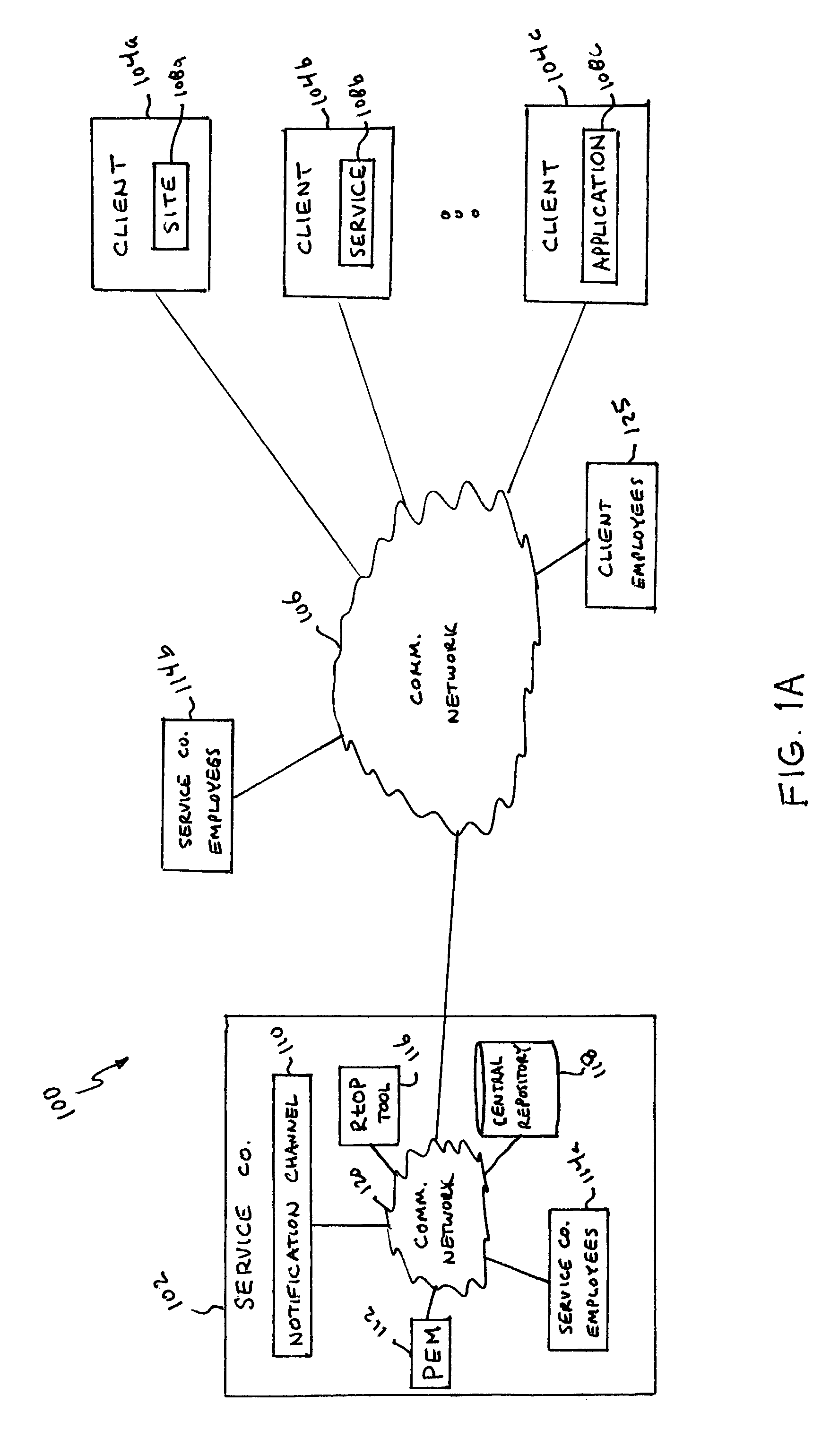

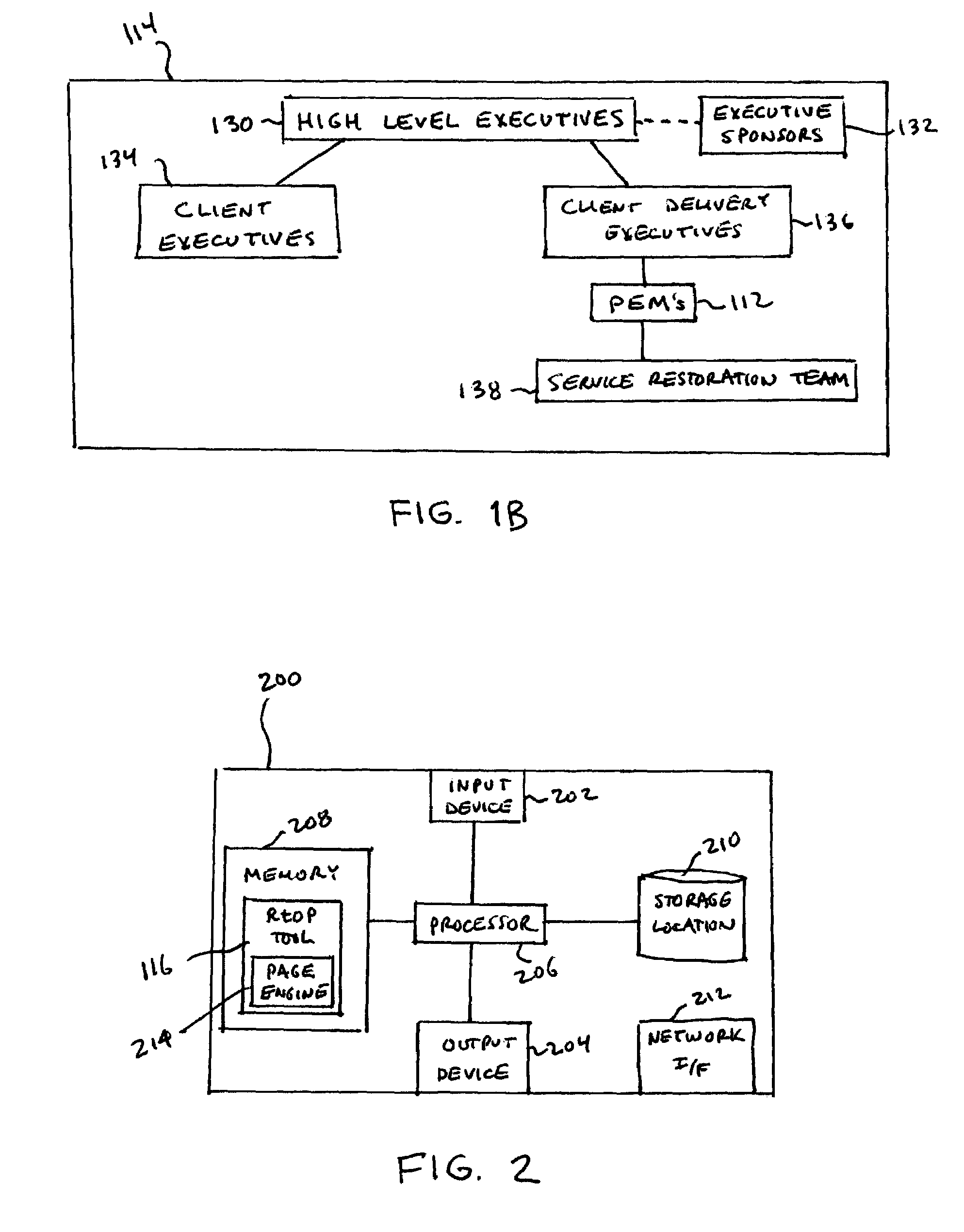

Method and system for addressing client service outages

According to one embodiment of the present invention, a computerized method for addressing client service outages of a client includes receiving a plurality of predefined parameters of a client service outage, storing the predefined parameters in a central repository, receiving information regarding the client service outage, determining that the client service outage is of a particular severity level in response to the received information, and automatically sending at least some of the information to one or more employees of a service company in response to the determination.

Owner:HEWLETT-PACKARD ENTERPRISE DEV LP

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com