Patents

Literature

87results about How to "Improve return" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

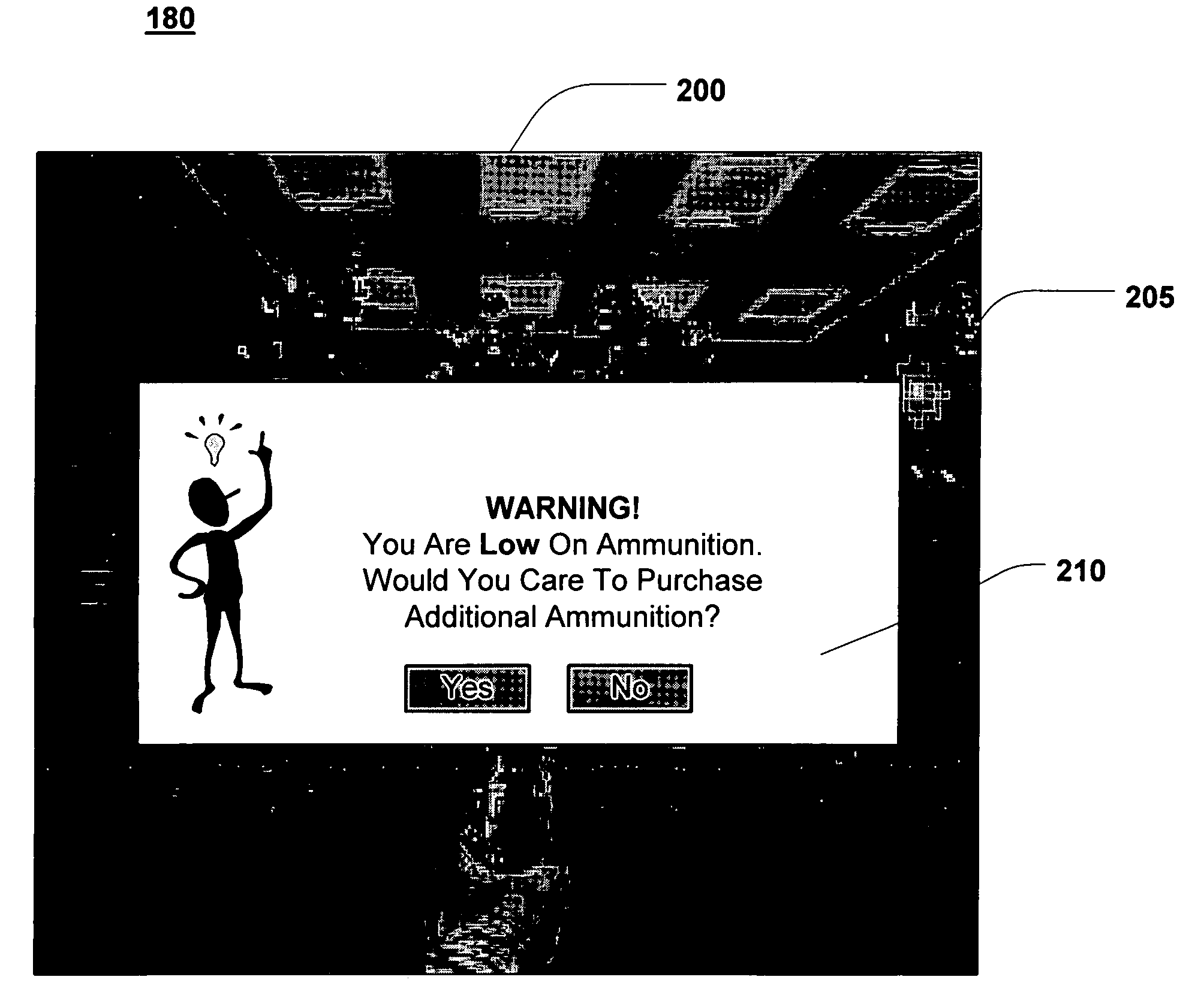

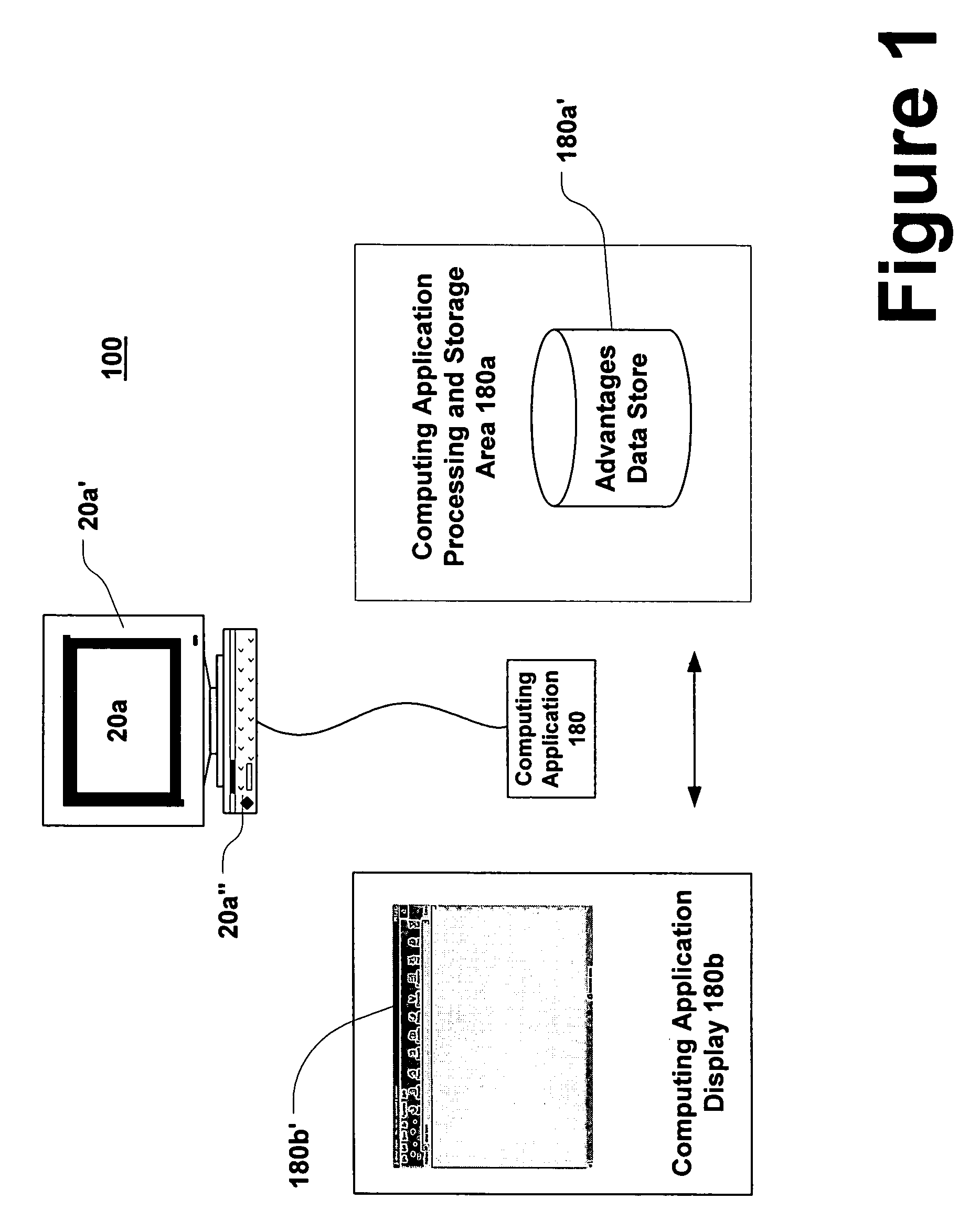

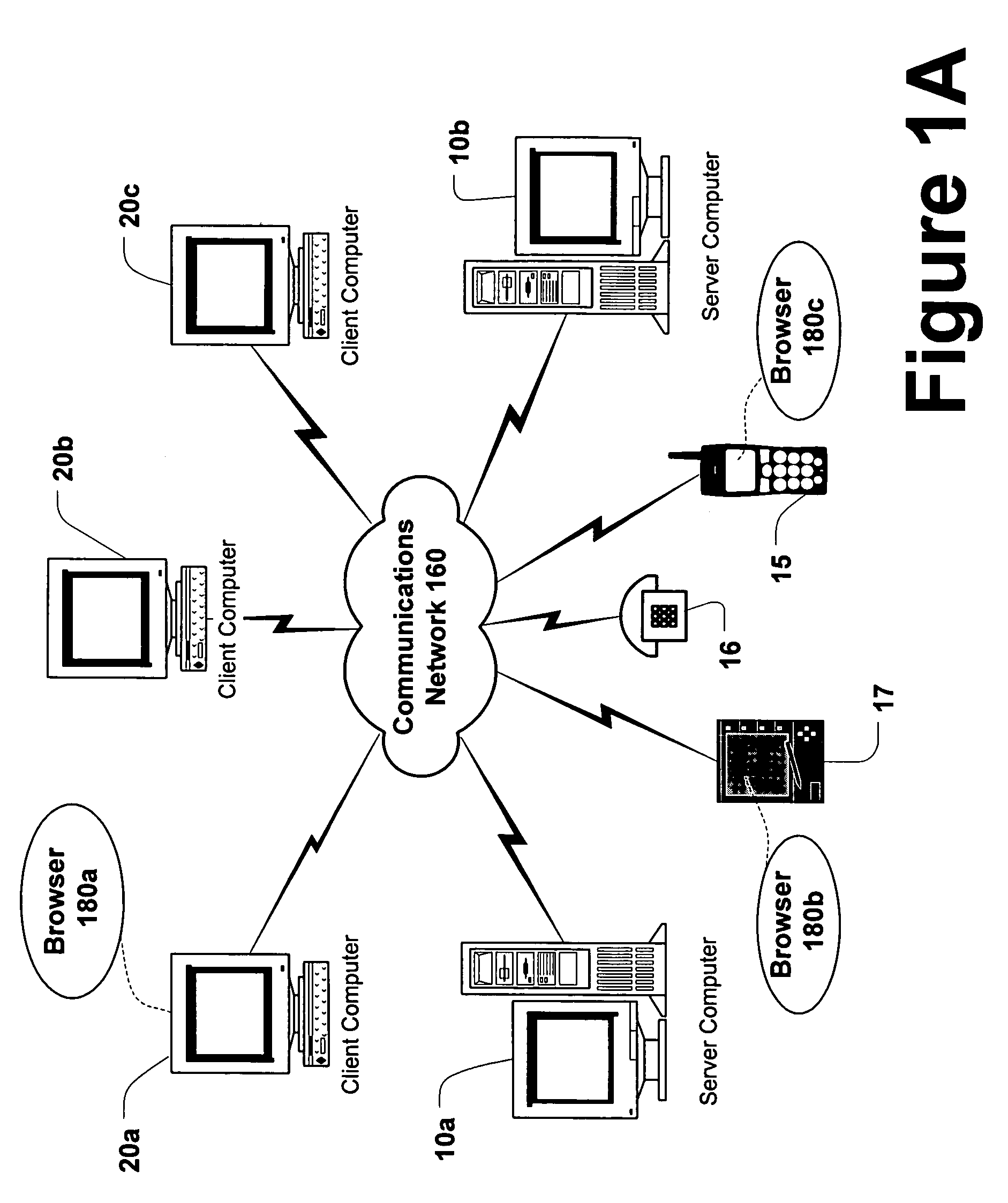

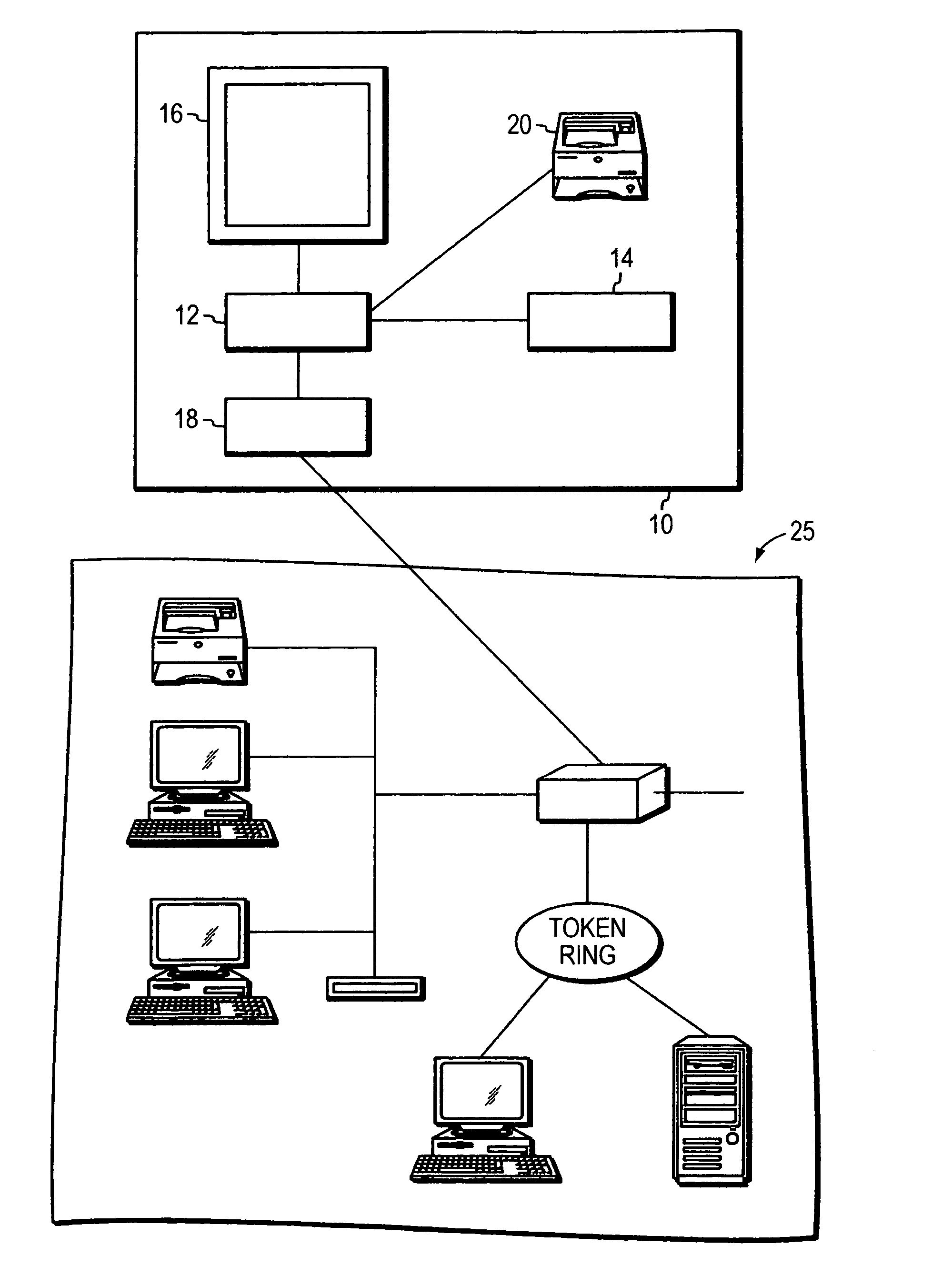

System and methods for obtaining advantages and transacting the same in a computer gaming environment

InactiveUS7076445B1Facilitate leveragingEnsure normal exposureDiscounts/incentivesAdvertisementsComputing systemsApplication software

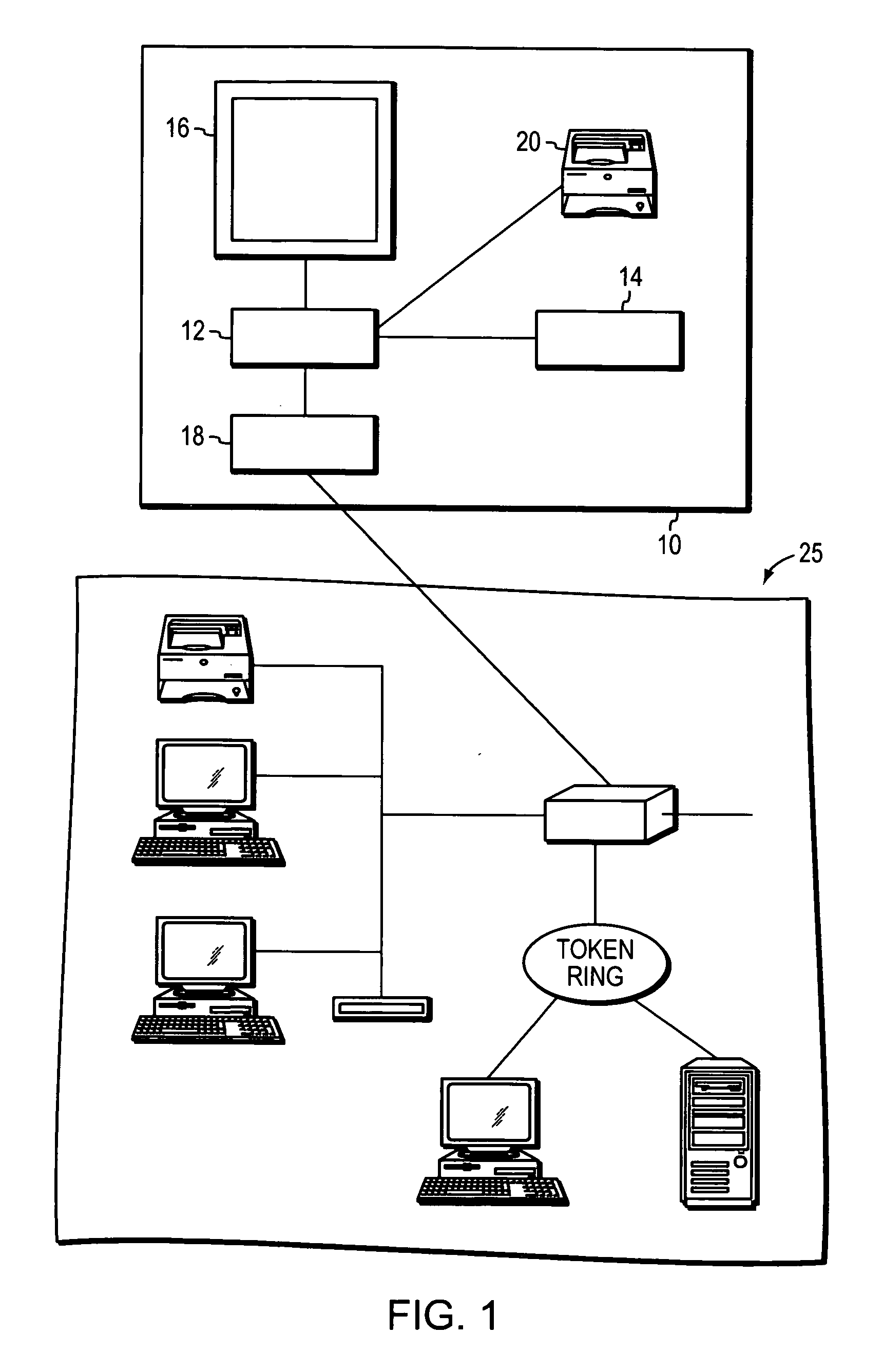

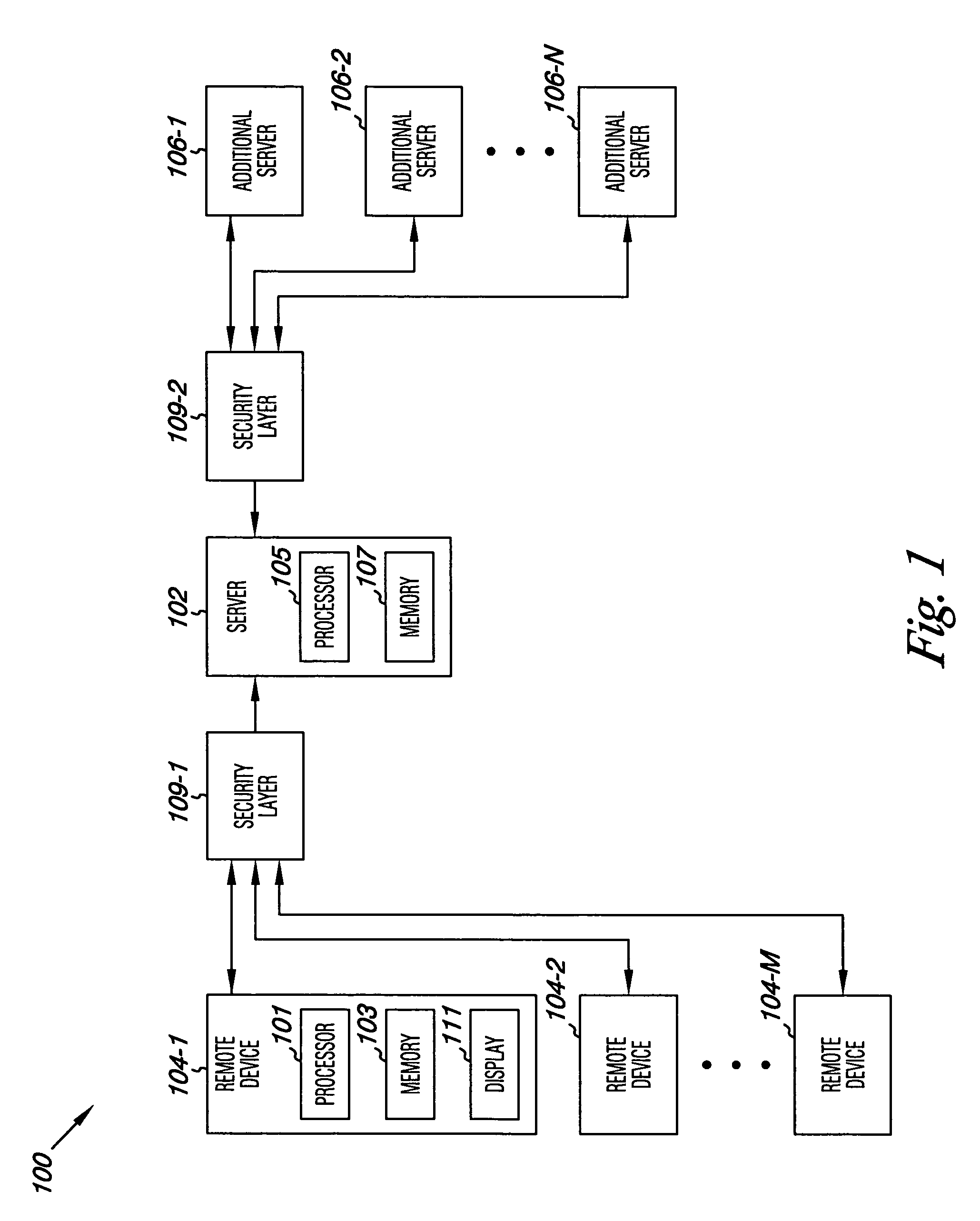

A system and methods allowing the creation, integration, and transaction of advantages (e.g. desired environment features and / or elements). In an illustrative implementation, the system may operate partially or completely in a computing environment. Where a computing environment is employed, the computing environment may support a computing application running on a stand alone or networked computing system. The computing application may maintain a user interface portion, a processing portion, and cooperate with a database. In operation, a user may register his / her profile information with an advantages content provider such that when navigating through the computing application, the user have access to and purchase offered advantages and interact with interactive advertisements to purchase products and / or services. The advantages may be retrieved from a cooperating database and provided to the user. A record of the transaction is stored by the computing application in accordance to user profile so that the user may be properly charged for the transacted advantages or purchased products and / or services.

Owner:GAMETEK

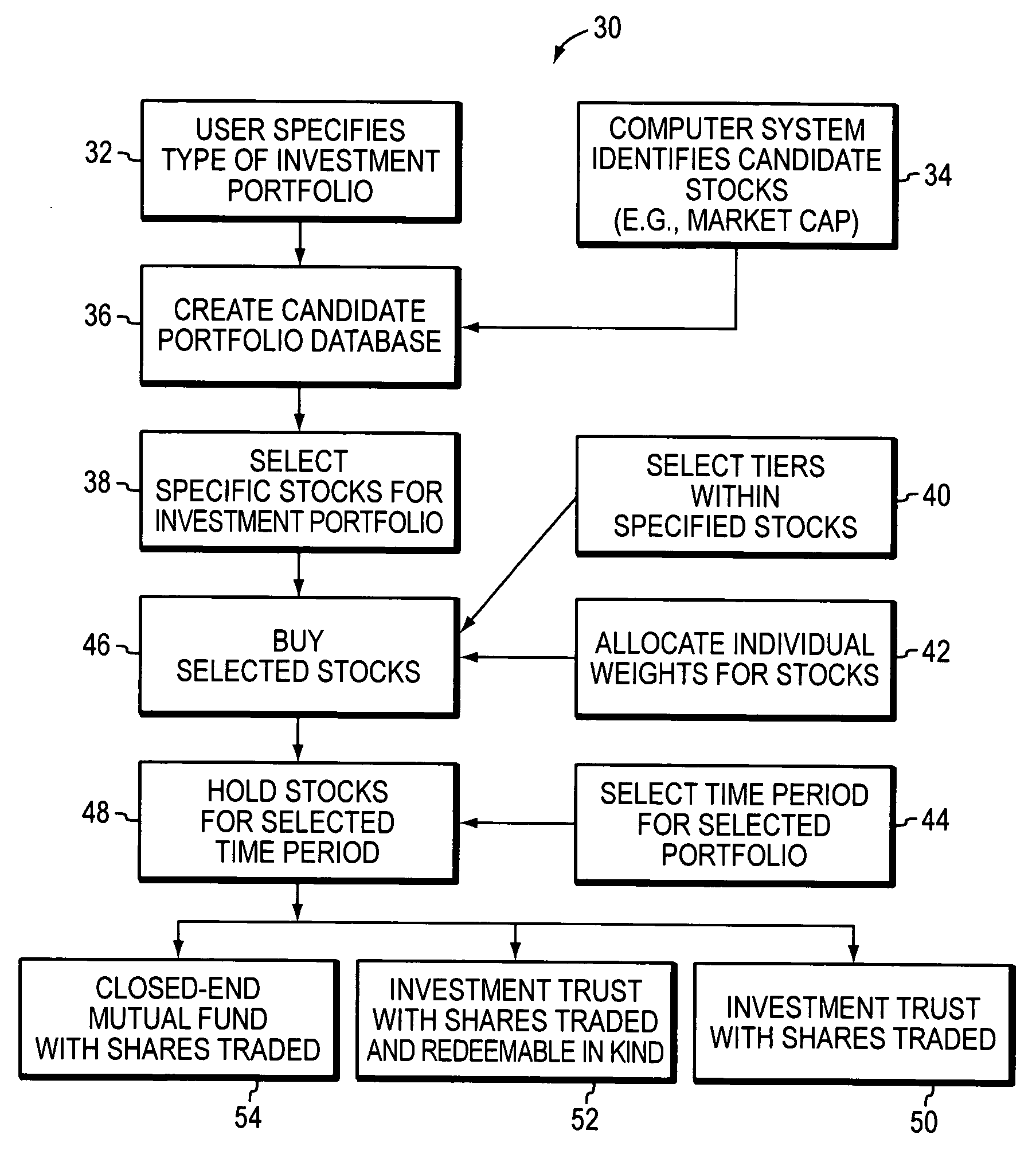

Long-term investing

InactiveUS7509278B2Improve returnLosing any momentumFinanceMarketingComputer scienceOperations research

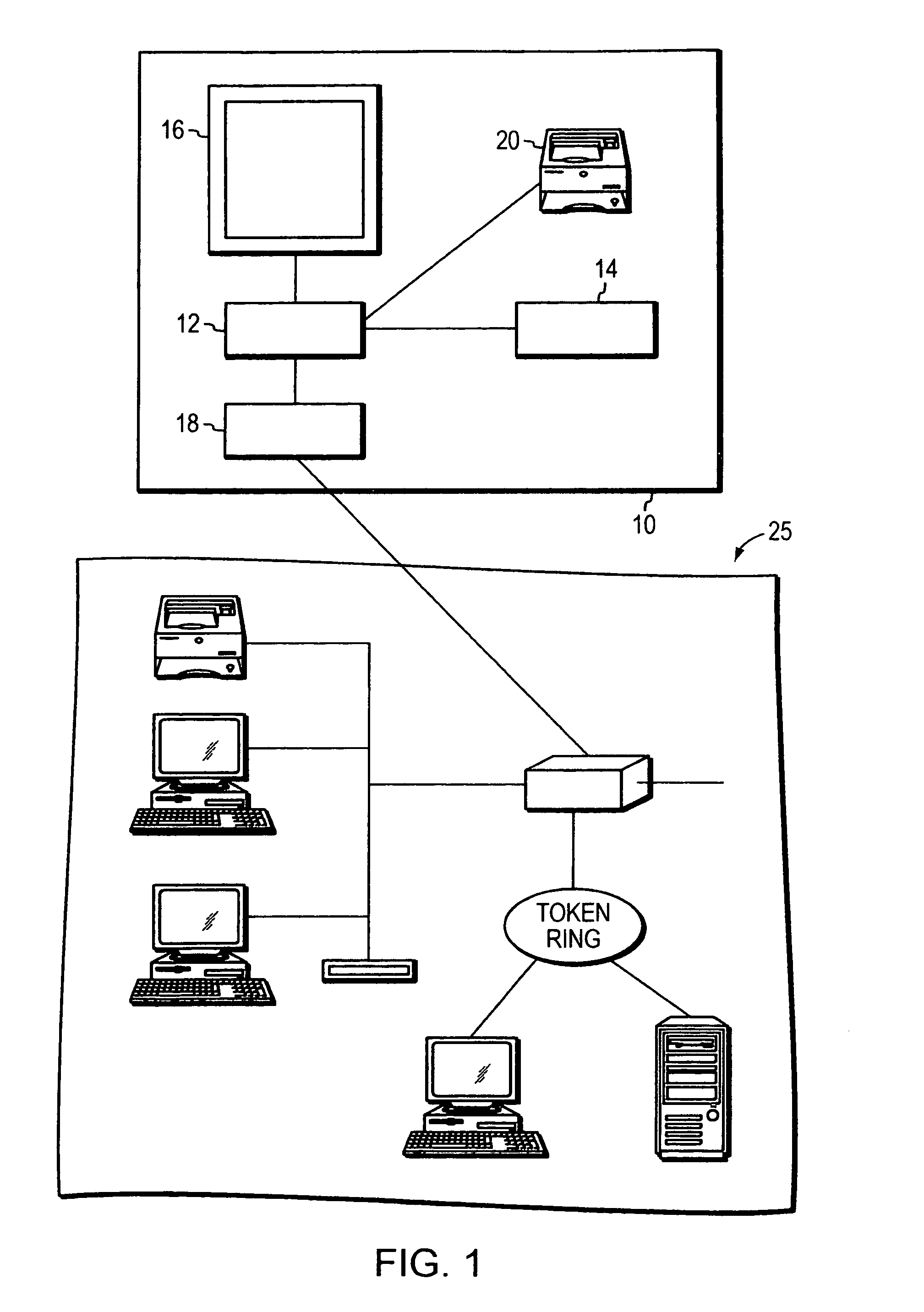

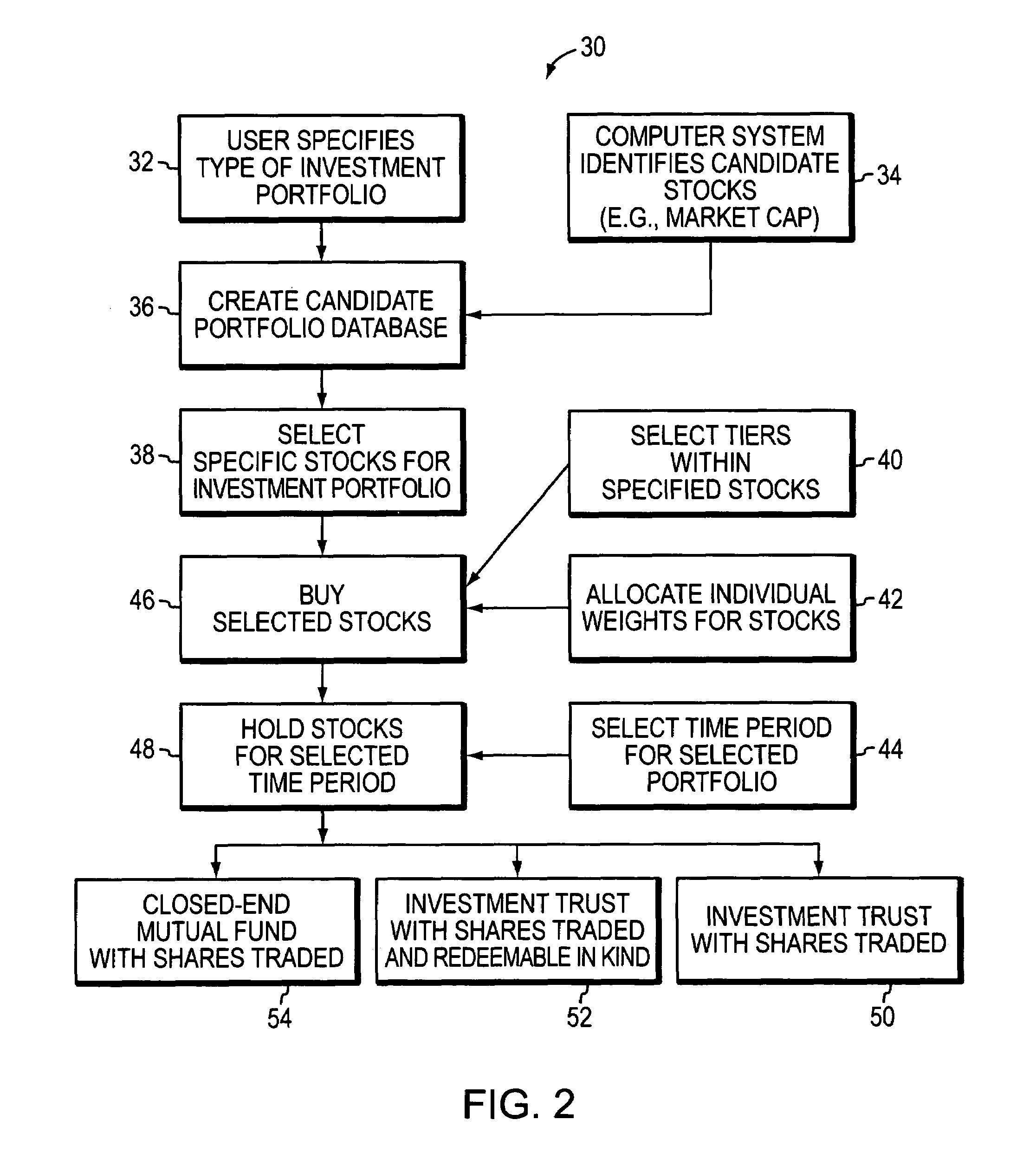

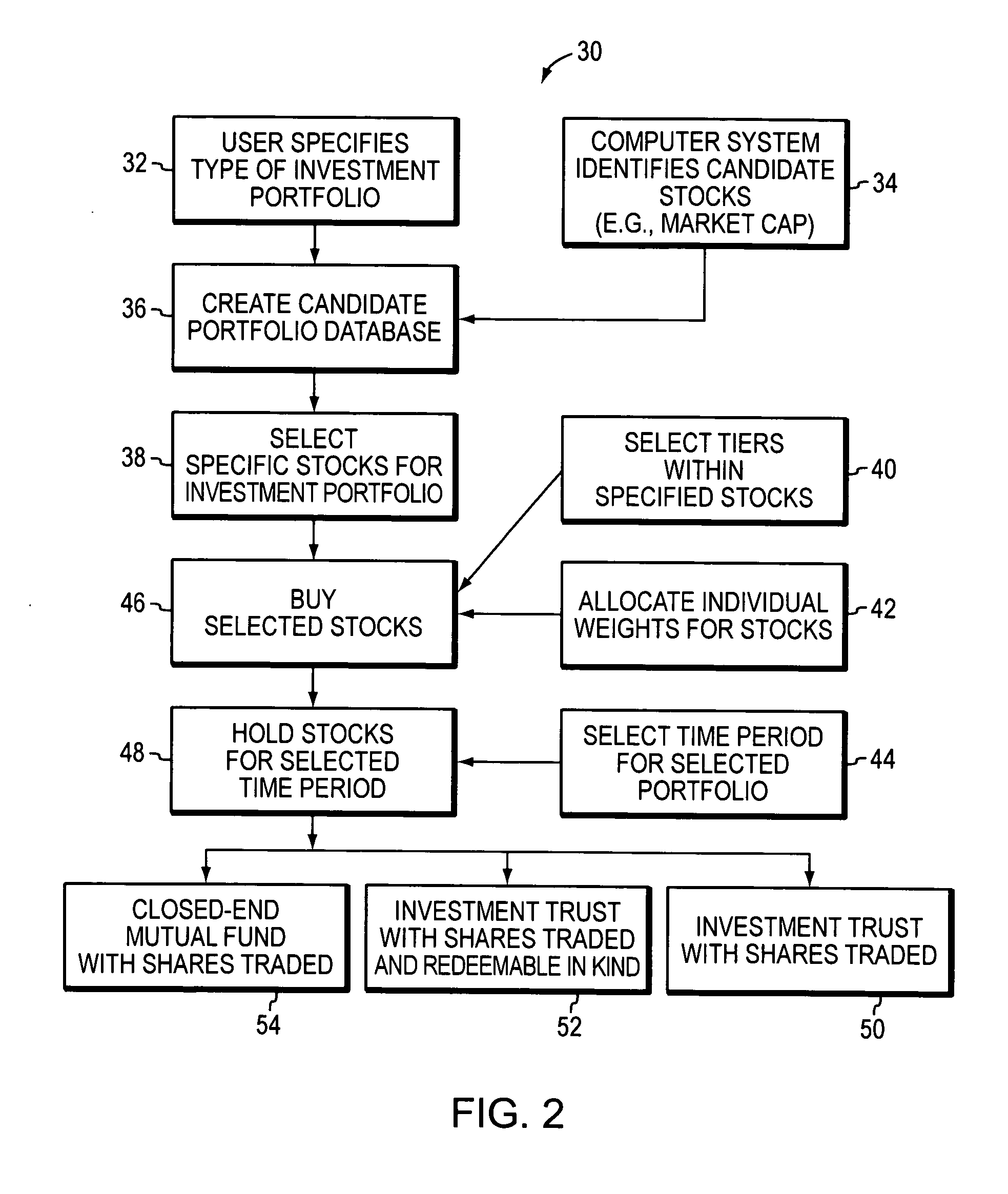

The present invention is a method, system and investment product for allocating or structuring investment assets (such as marketable securities, bonds, mortgages, or other property interests, options or derivatives). The system, method or product enables selecting or grouping a number of individual financial instruments together into a portfolio (e.g., a fund or trust) and assigning weight coefficients to the selected financial instruments based upon a predetermined scale. After assigning the weight coefficients, the system or method purchases the selected instruments based on the allocated total purchase for each instrument (i.e., the total price of each instrument reflects is the price per unit×number of units, which correspond the predetermined weight coefficient). Then, the purchased individual financial instruments are allowed to fluctuate and perform for a predetermined time period (i.e., a number of years and months) without any further significant adjustments to the initial portfolio.

Owner:JONES W RICHARD

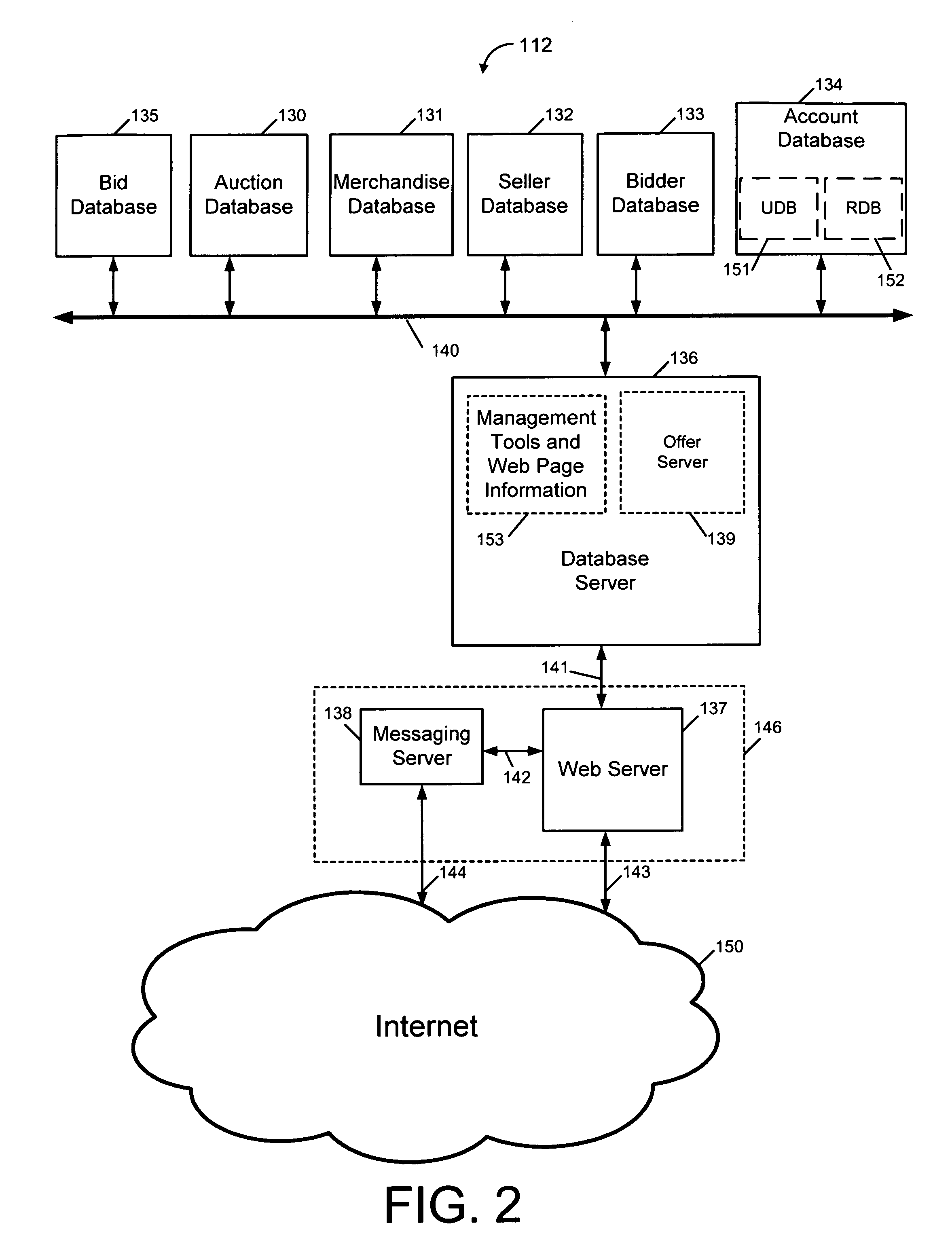

Auction redemption system and method

InactiveUS7461022B1Improve returnZero marginal cost to runFinanceReservationsPaymentMessage delivery

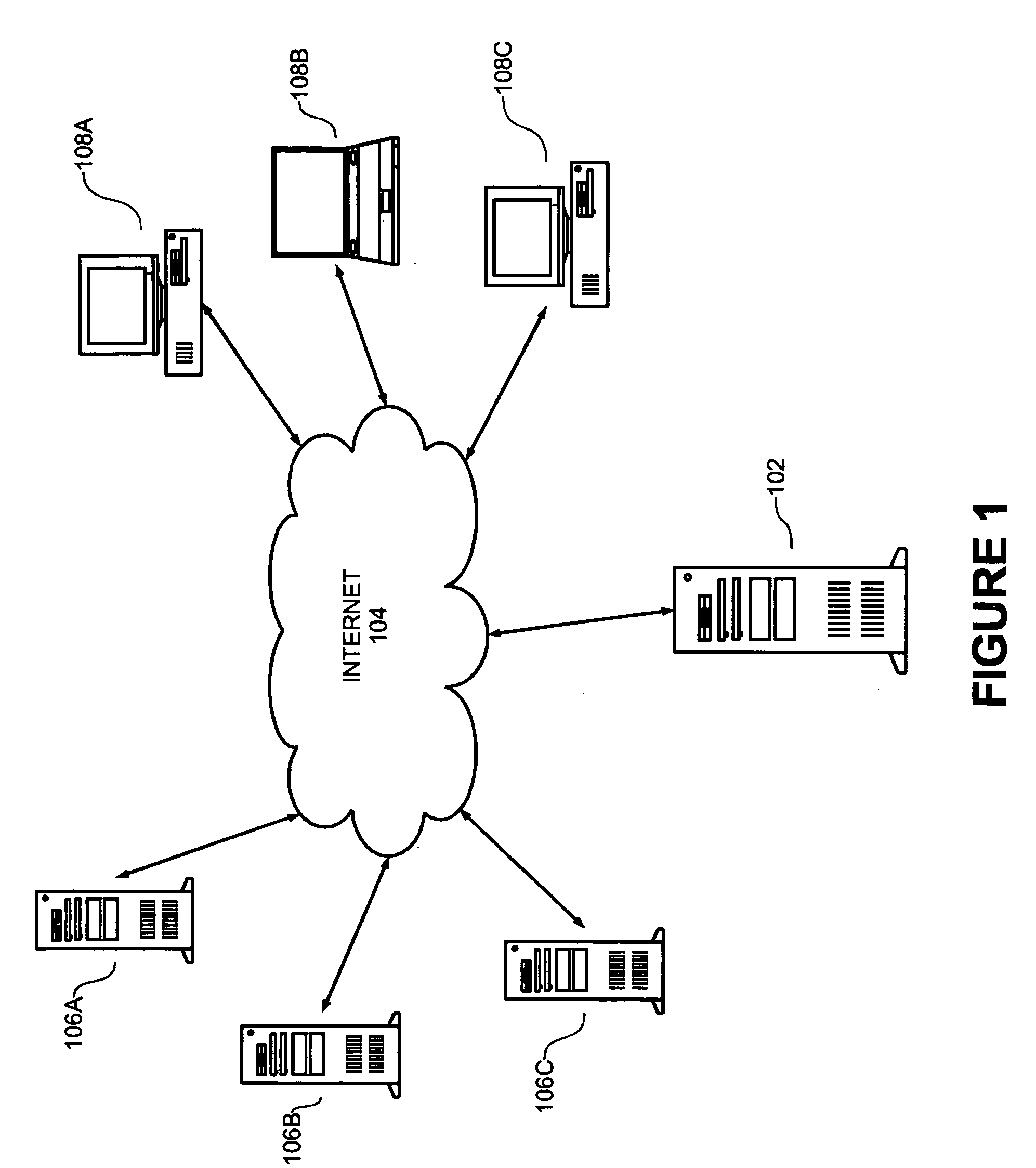

An electronic auction system known as the Yahoo! Auction System provides functionality that permits users to conduct auction transactions with various payment units, such as incentive points and credit points, as well as money. Points can be earned in a variety of ways and redeemed via online auctions. The Yahoo! Auction System includes a web server, a messaging server, a database server, and various databases including an account database for storing information about account balance, expiration date for each point or group of points, and redemption information. The Yahoo! Auction System provides different auction formats, such as Standard Auction, Dutch Auction, Progressive Auction, Buy-or-Bid Auction, and Declining Bid Auction. The Yahoo! Auction System reserves the bid amount associated any new valid bid in the bidder's account and unreserves those bid amounts that were previously reserved but are no longer the winning bid or otherwise displaced from the top bid positions.

Owner:R2 SOLUTIONS

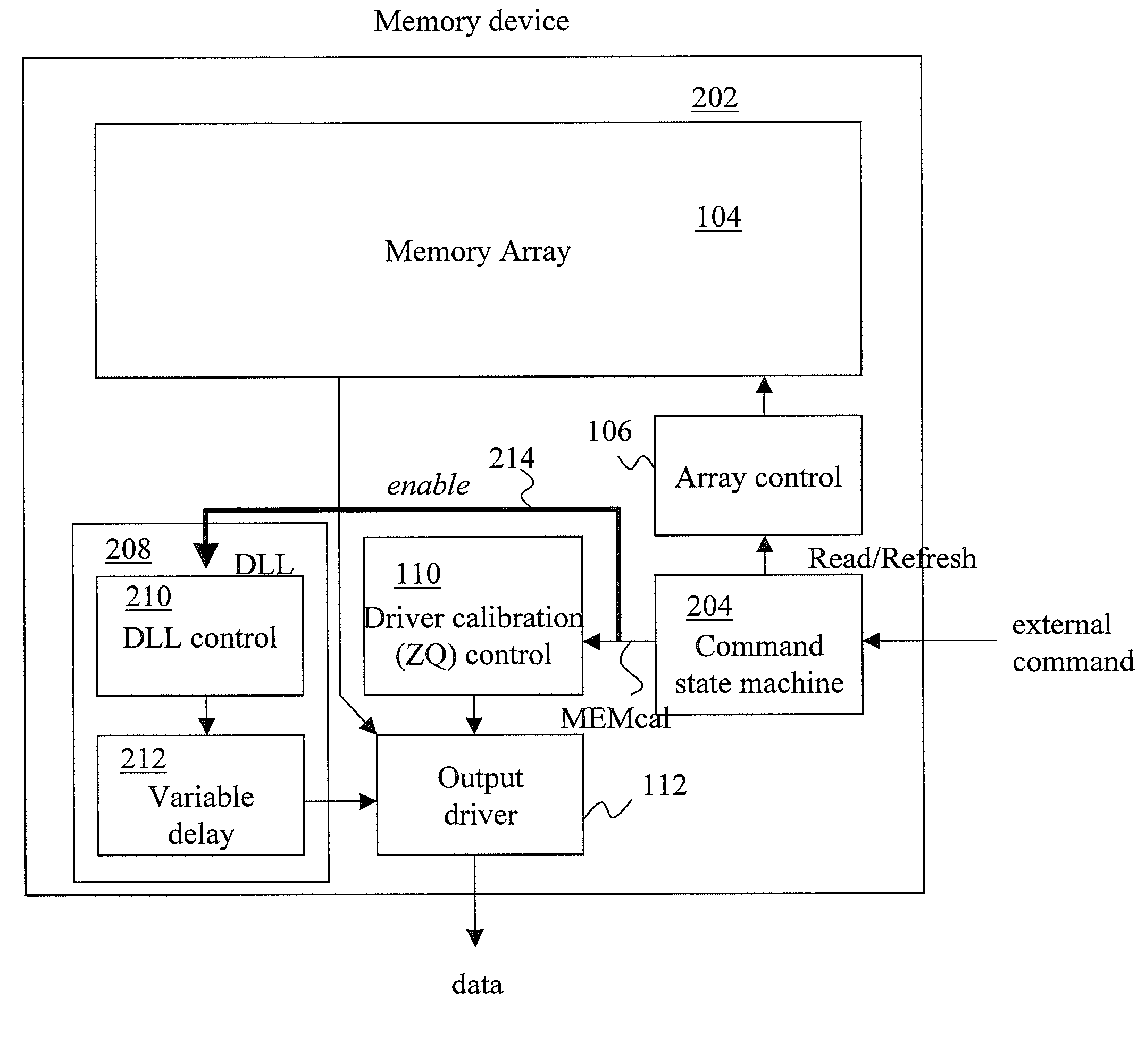

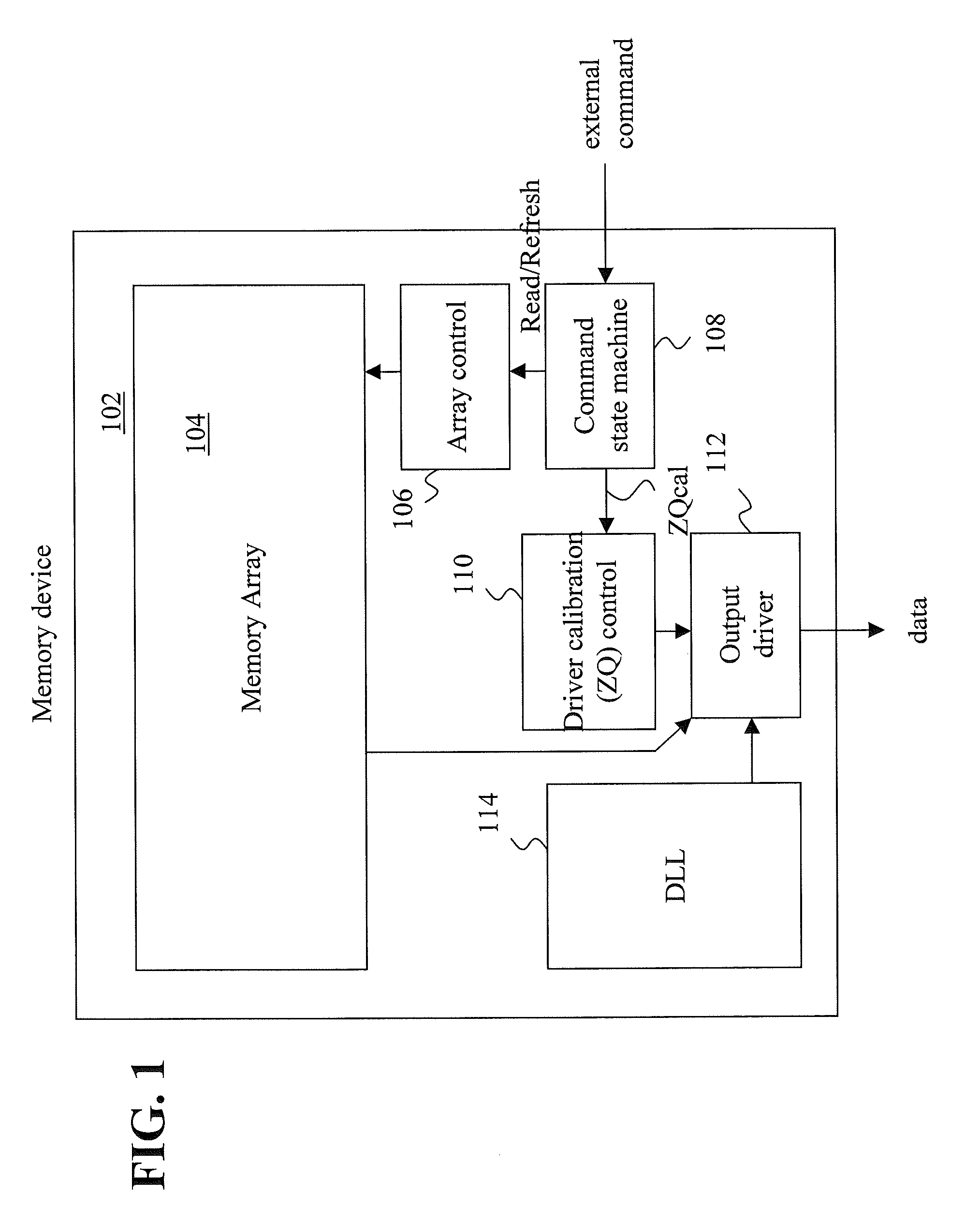

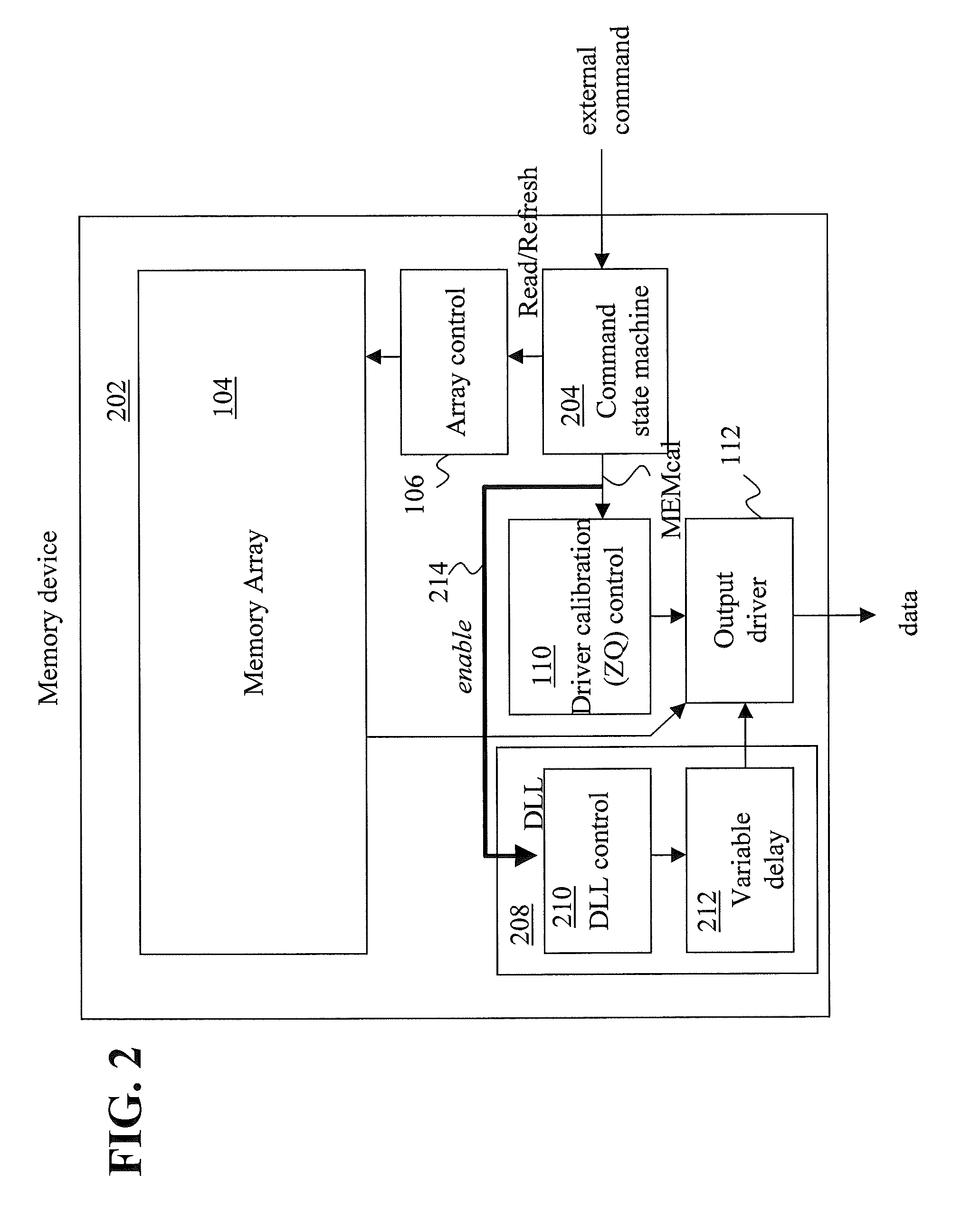

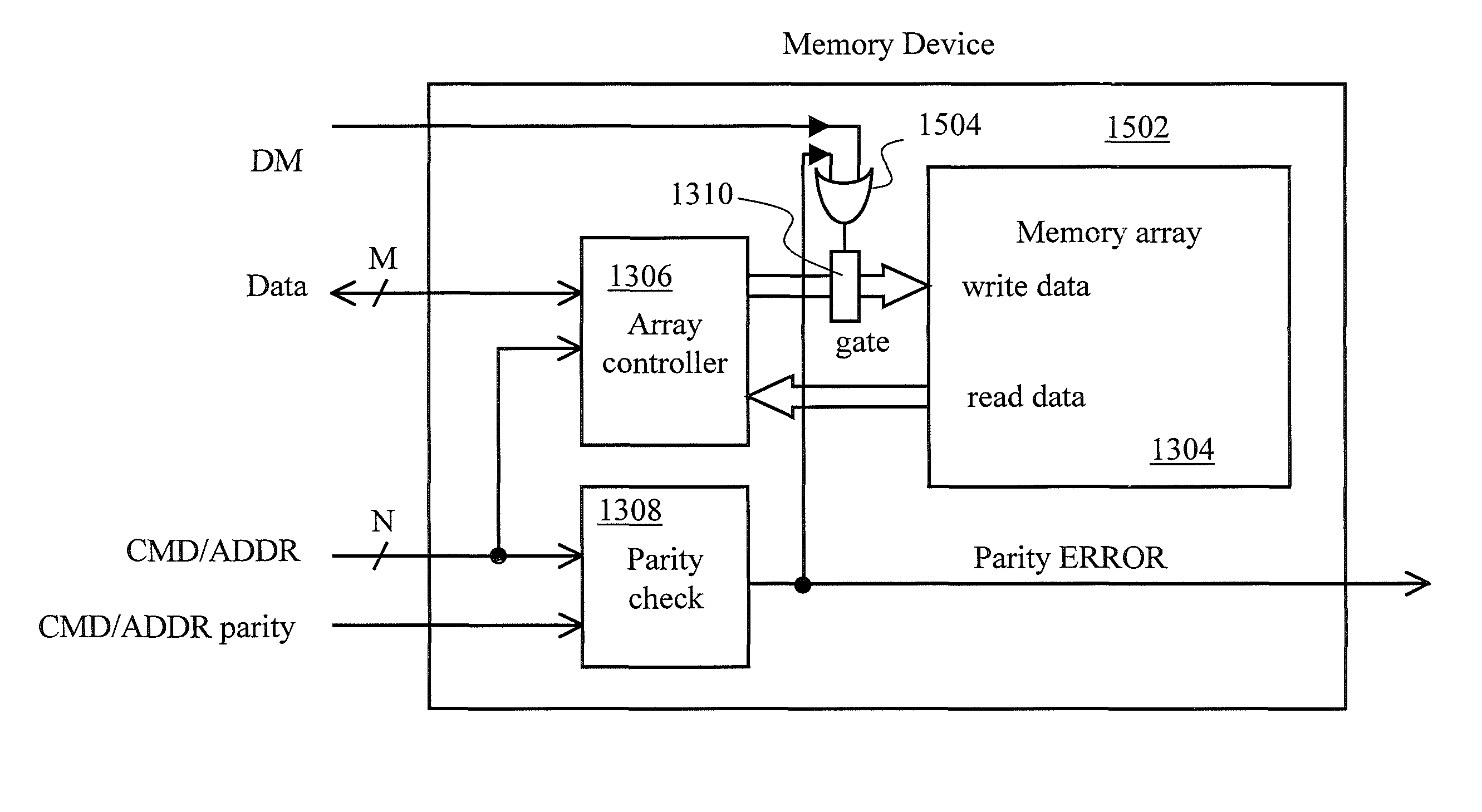

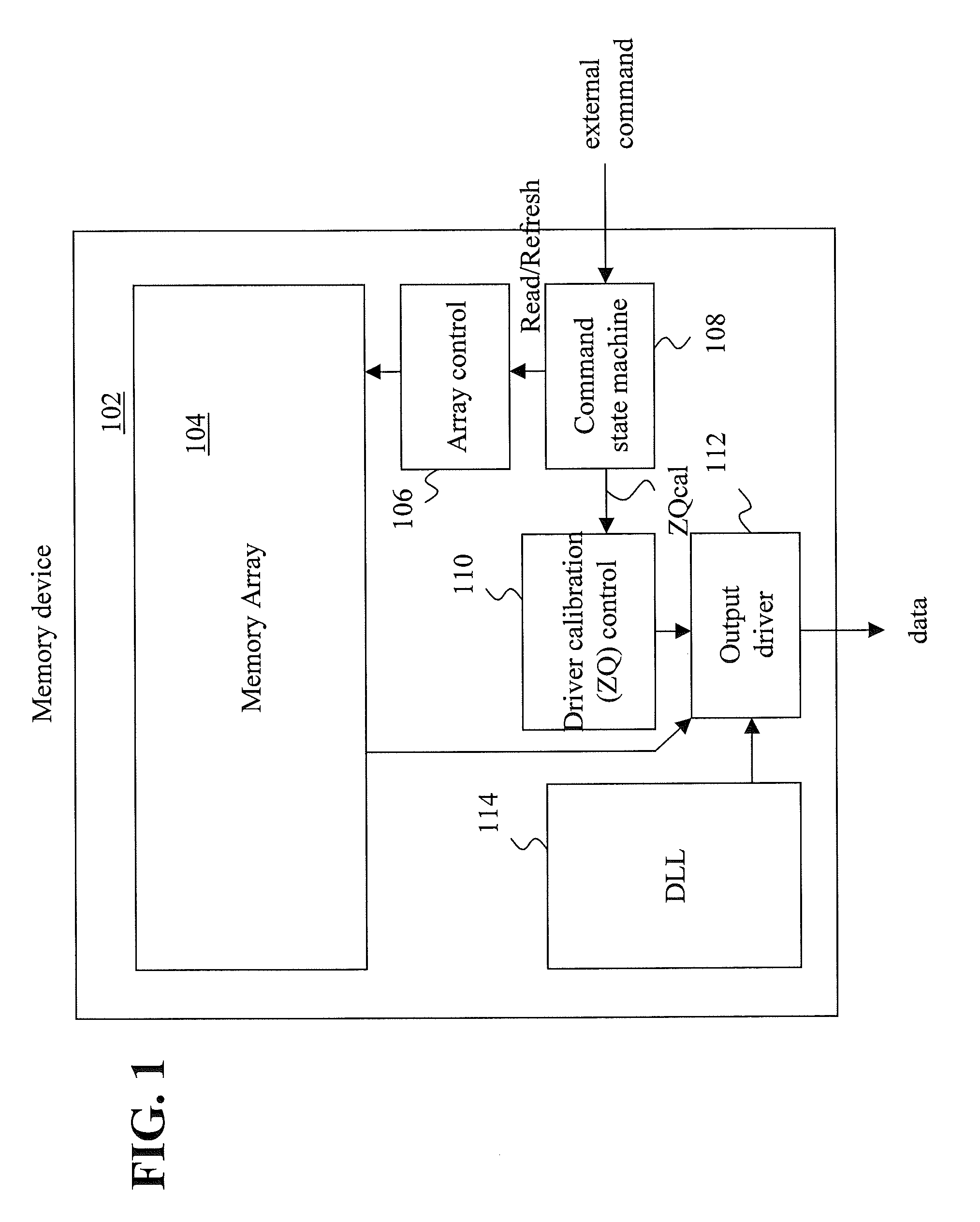

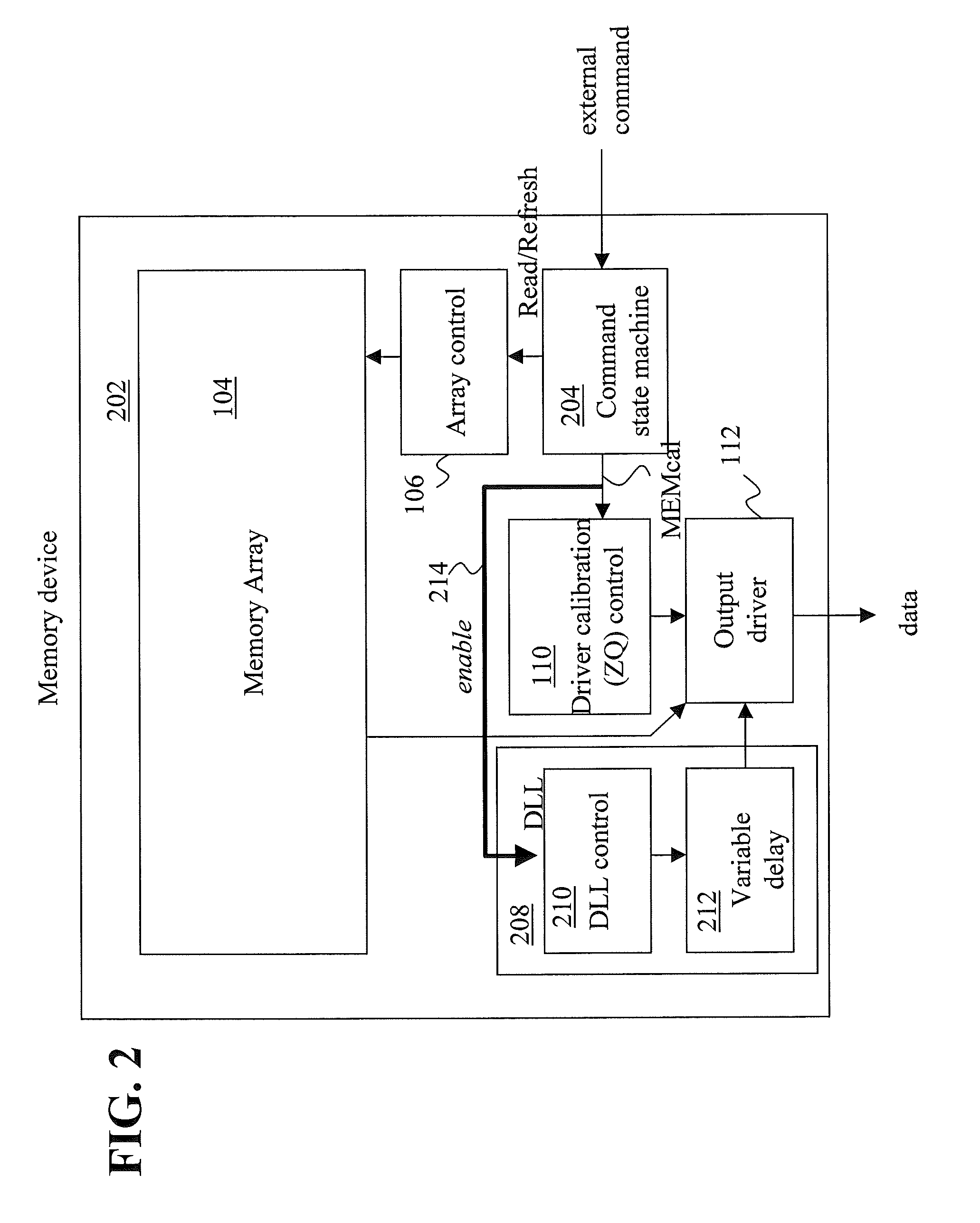

Advanced memory device having improved performance, reduced power and increased reliability

An advanced memory having improved performance, reduced power and increased reliability. A memory device includes a memory array, a receiver for receiving a command and associated data, error control coding circuitry for performing error control checking on the received command, and data masking circuitry for preventing the associated data from being written to the memory array in response to the error control coding circuitry detecting an error in the received command. Another memory device includes a programmable preamble. Another memory device includes a fast exit self-refresh mode. Another memory device includes auto refresh function that is controlled by the characteristic device. Another memory device includes an auto refresh function that is controlled by a characteristic of the memory device.

Owner:GLOBALFOUNDRIES US INC

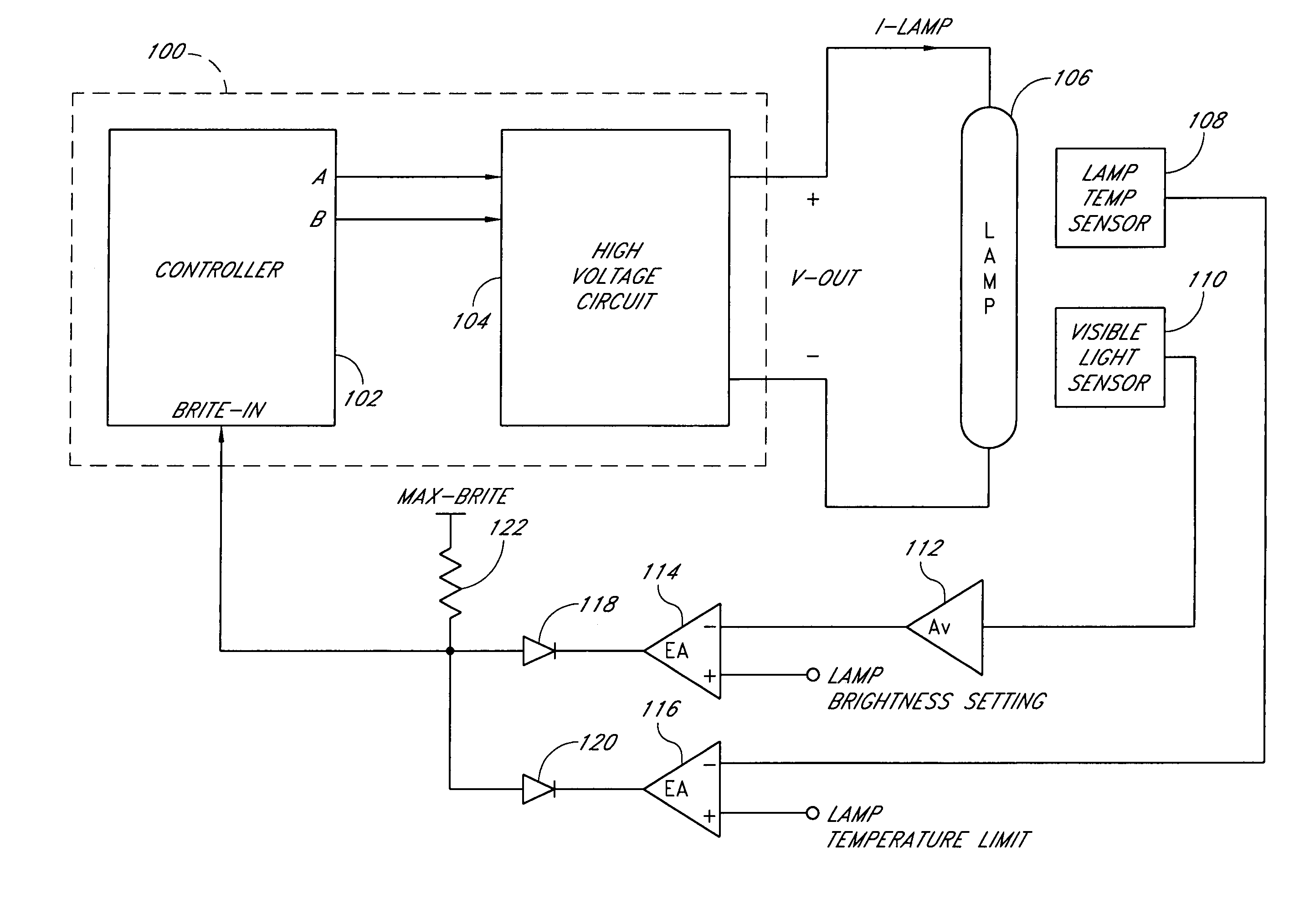

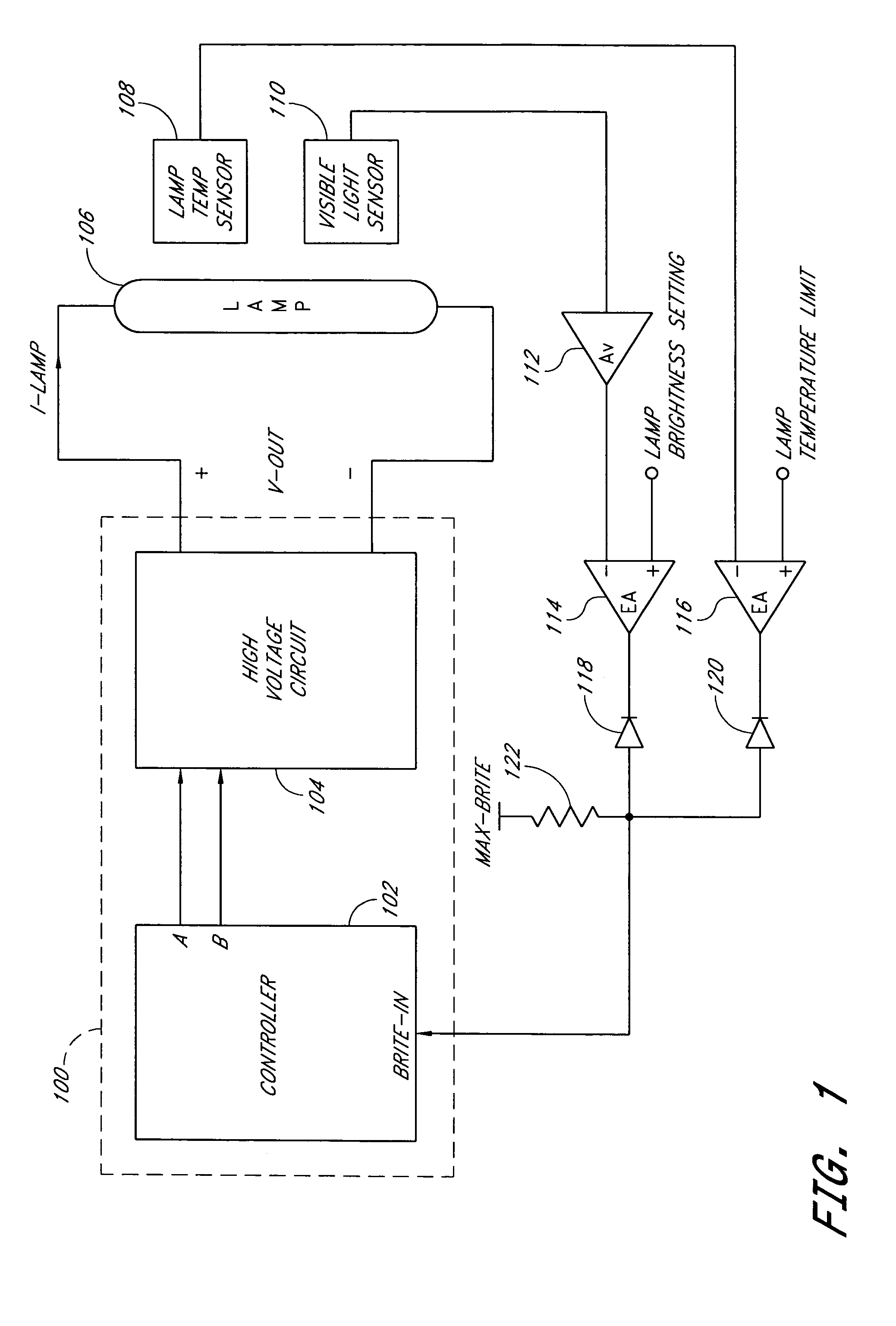

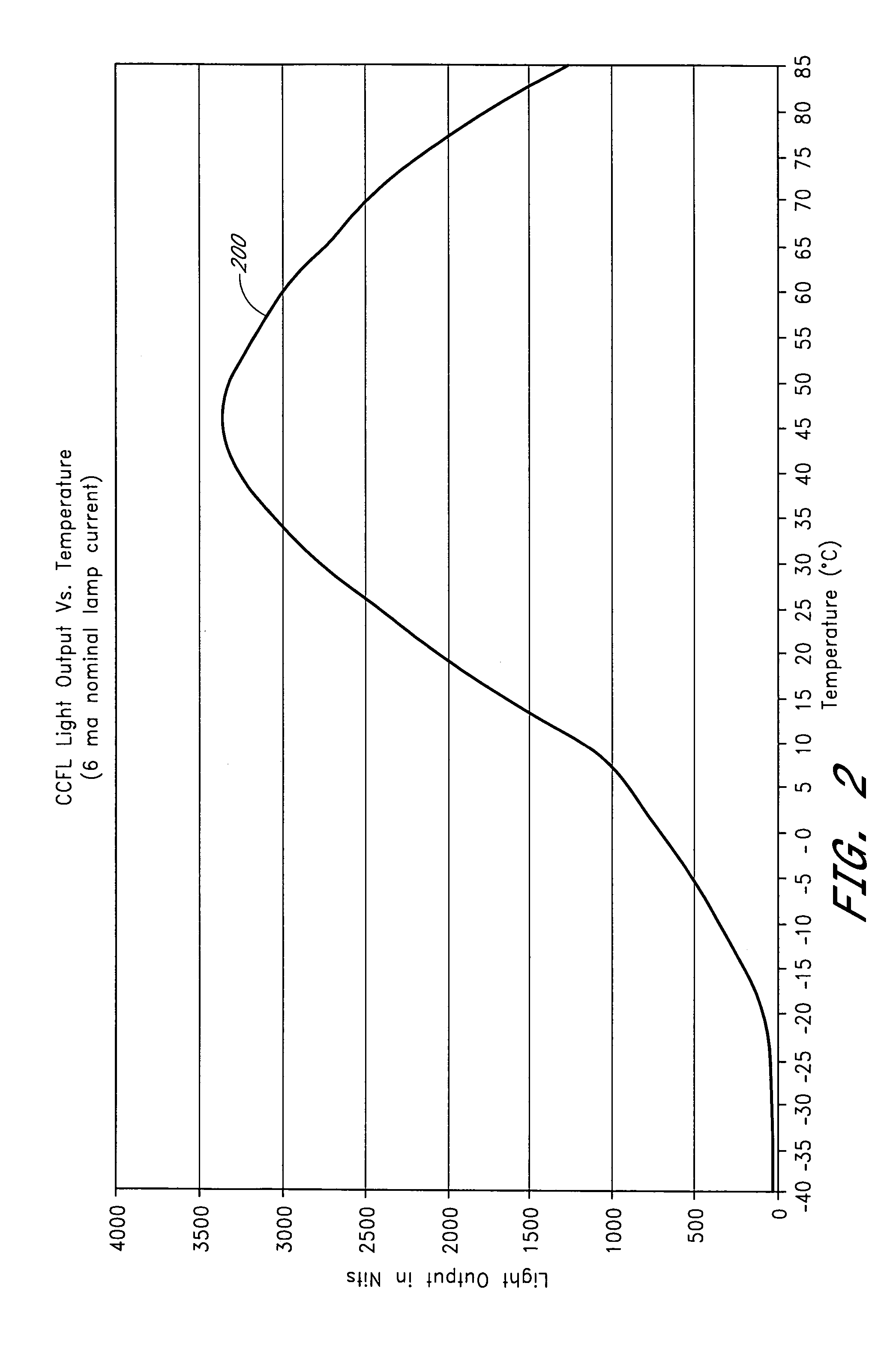

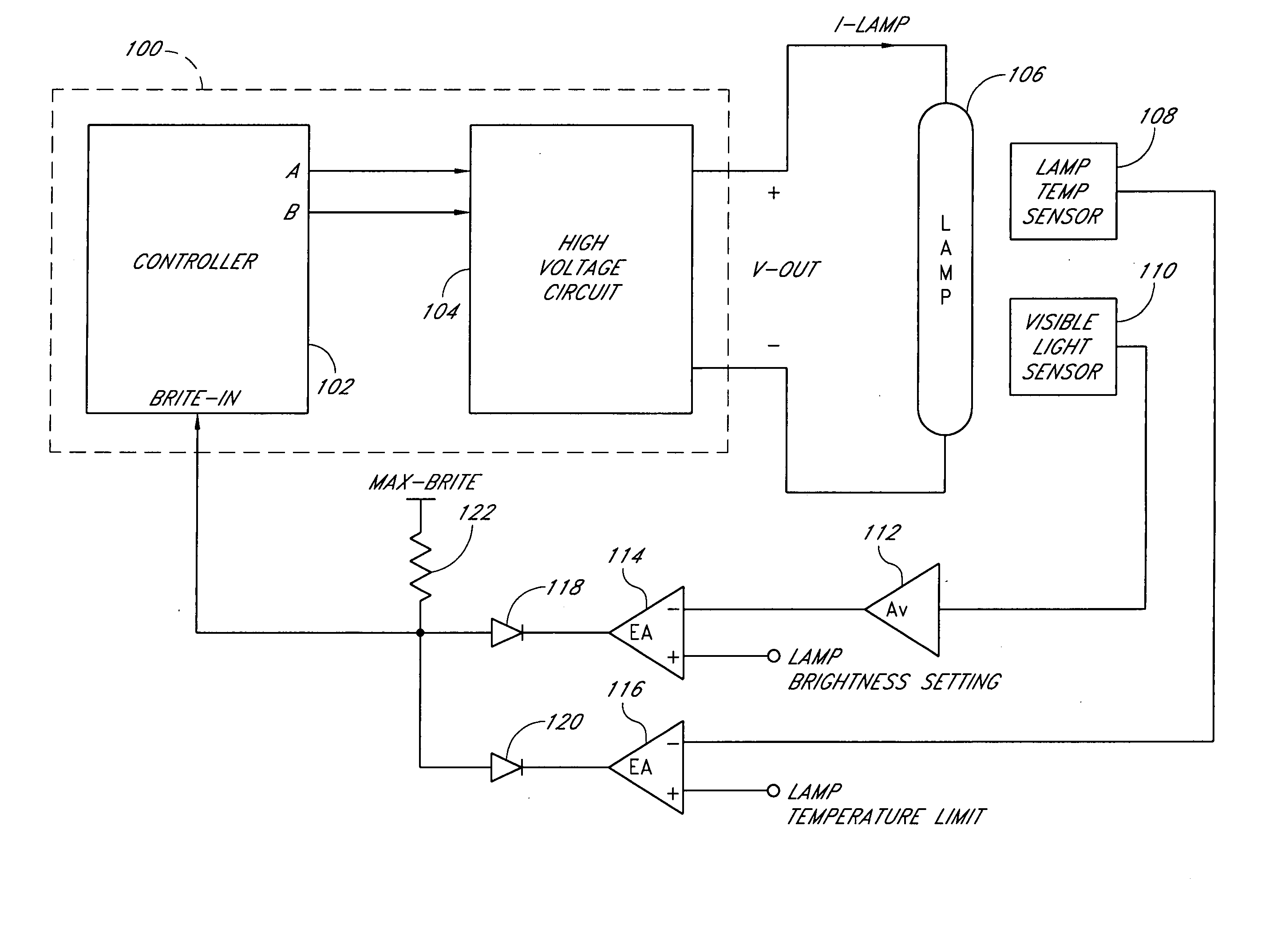

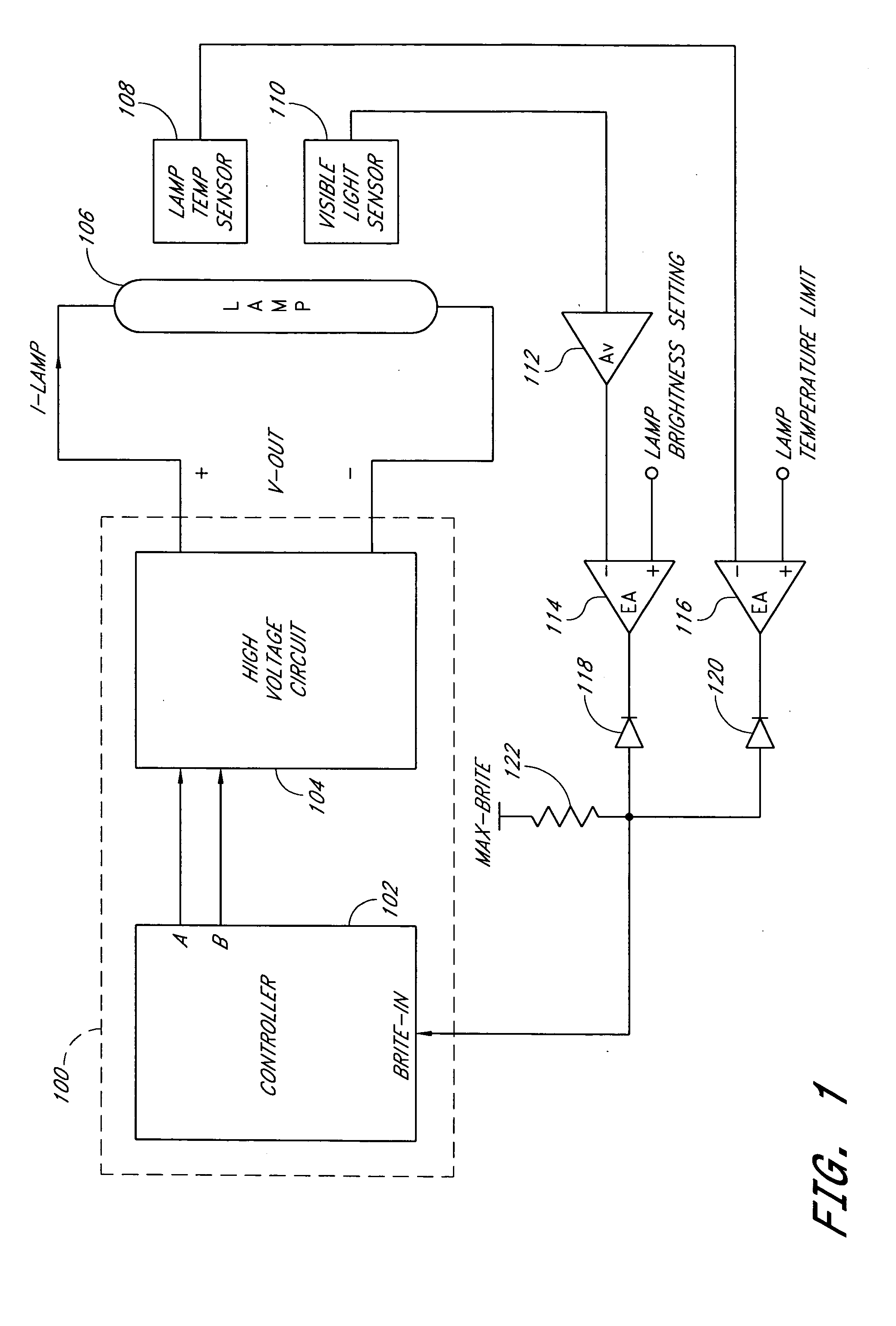

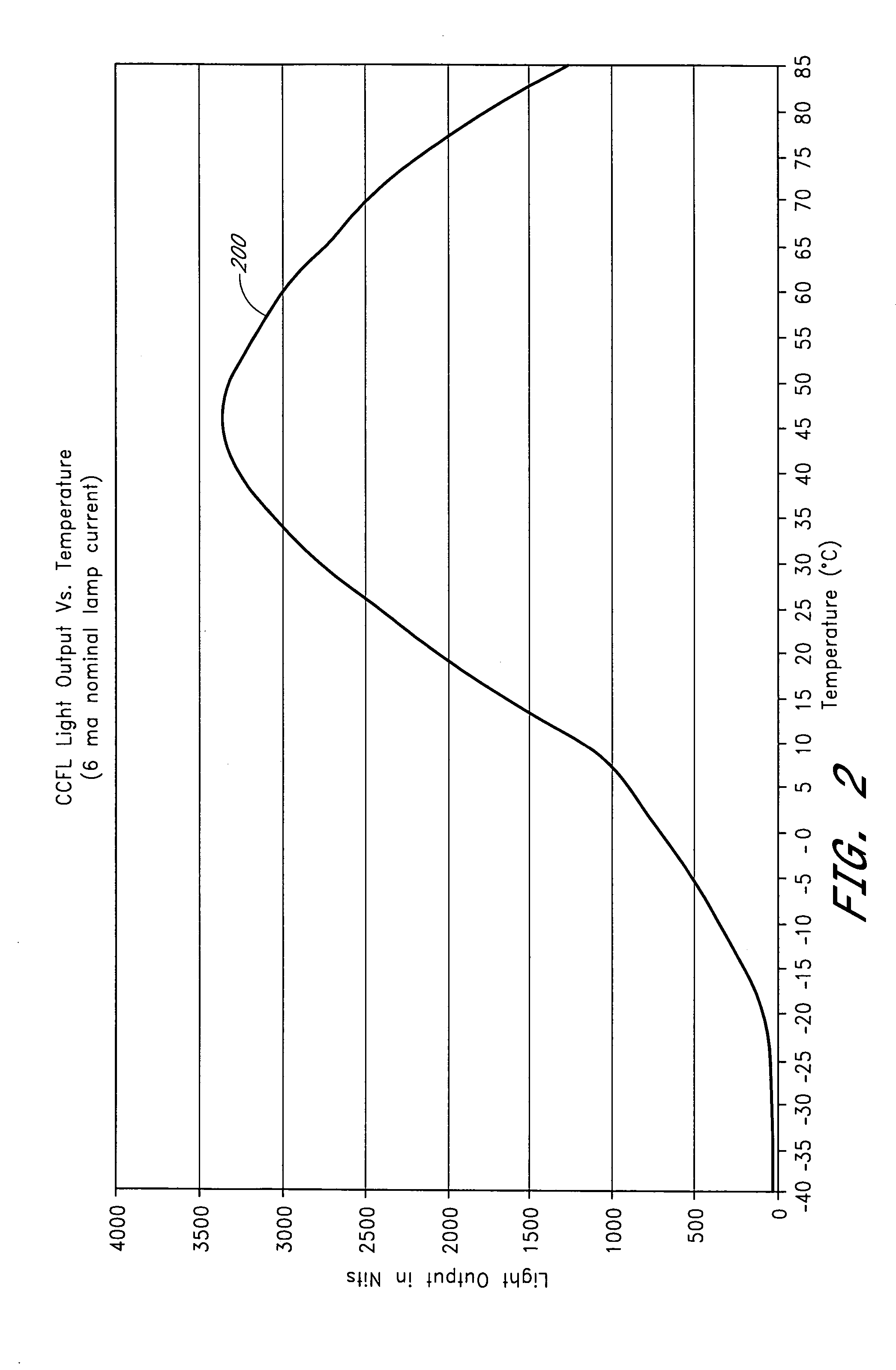

Optical and temperature feedbacks to control display brightness

ActiveUS7183727B2Extend lamp lifeReduce the required powerElectrical apparatusStatic indicating devicesControl powerFeedback control

An illumination control circuit allows a user to set a desired brightness level and maintains the desired brightness level over temperature and life of a light source. The illumination control circuit uses a dual feedback loop with both optical and thermal feedbacks. The optical feedback loop controls power to the light source during normal operations. The thermal feedback loop overrides the optical feedback loop when the temperature of the light source becomes excessive.

Owner:POLARIS POWERLED TECH LLC

Investment portfolio

InactiveUS20050060254A1Optimal returnHealthy earningsFinanceSpecial data processing applicationsWeighting coefficientWeight coefficient

The present invention is a method, system and investment product for allocating or structuring investment assets (such as marketable securities, bonds, mortgages, or other property interests, options or derivatives). The system, method or product enables selecting or grouping a number of individual financial instruments together into a portfolio (e.g., a fund or trust) and assigning weight coefficients to the selected financial instruments based upon a predetermined scale. After assigning the weight coefficients, the system or method purchases the selected instruments based on the allocated total purchase for each instrument (i.e., the total price of each instrument reflects is the price per unit×number of units, which correspond the predetermined weight coefficient). Then, the purchased individual financial instruments are allowed to fluctuate and perform for a predetermined time period (i.e., a number of years and months) without any further significant adjustments to the initial portfolio.

Owner:JONES W RICHARD

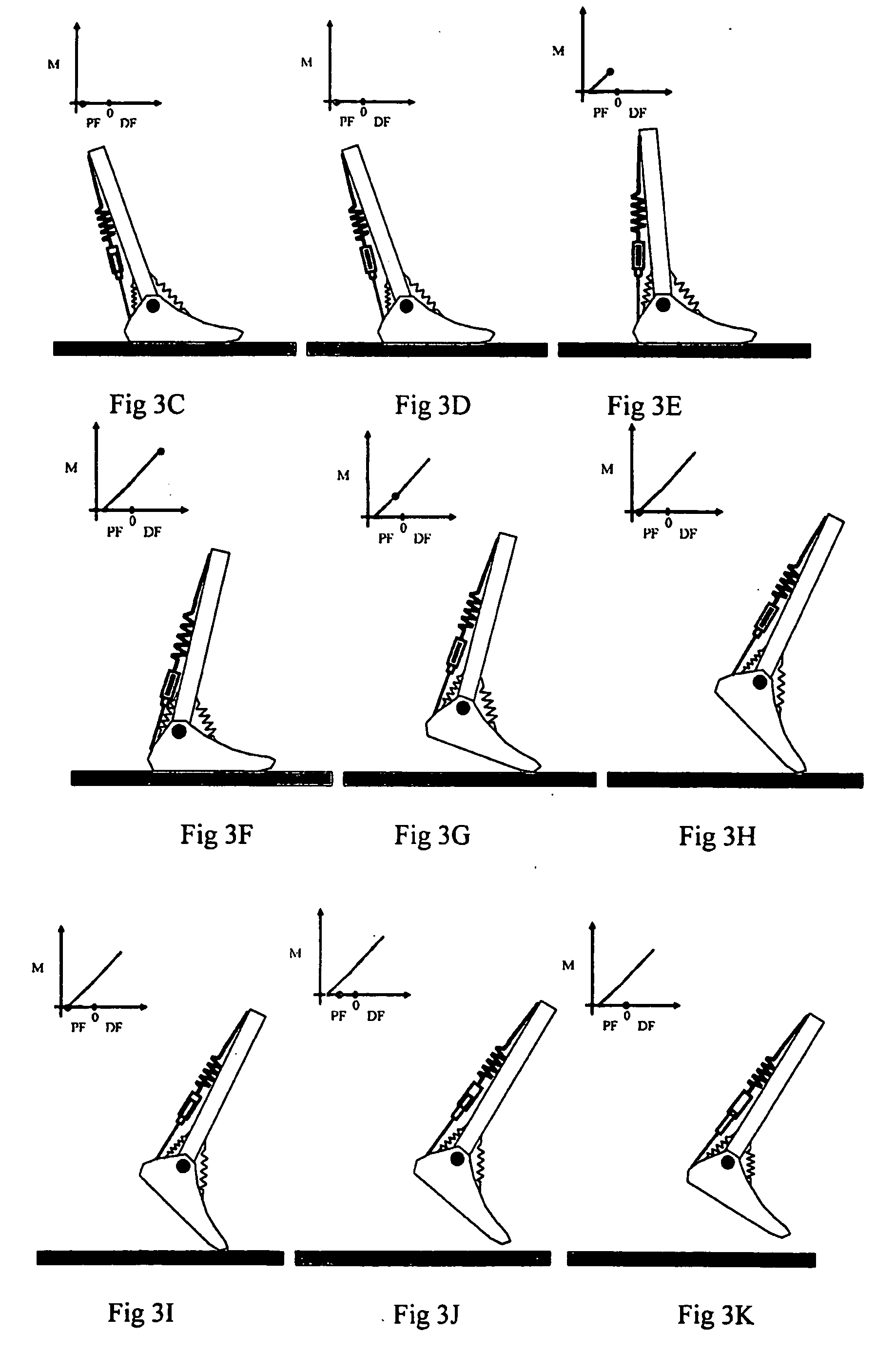

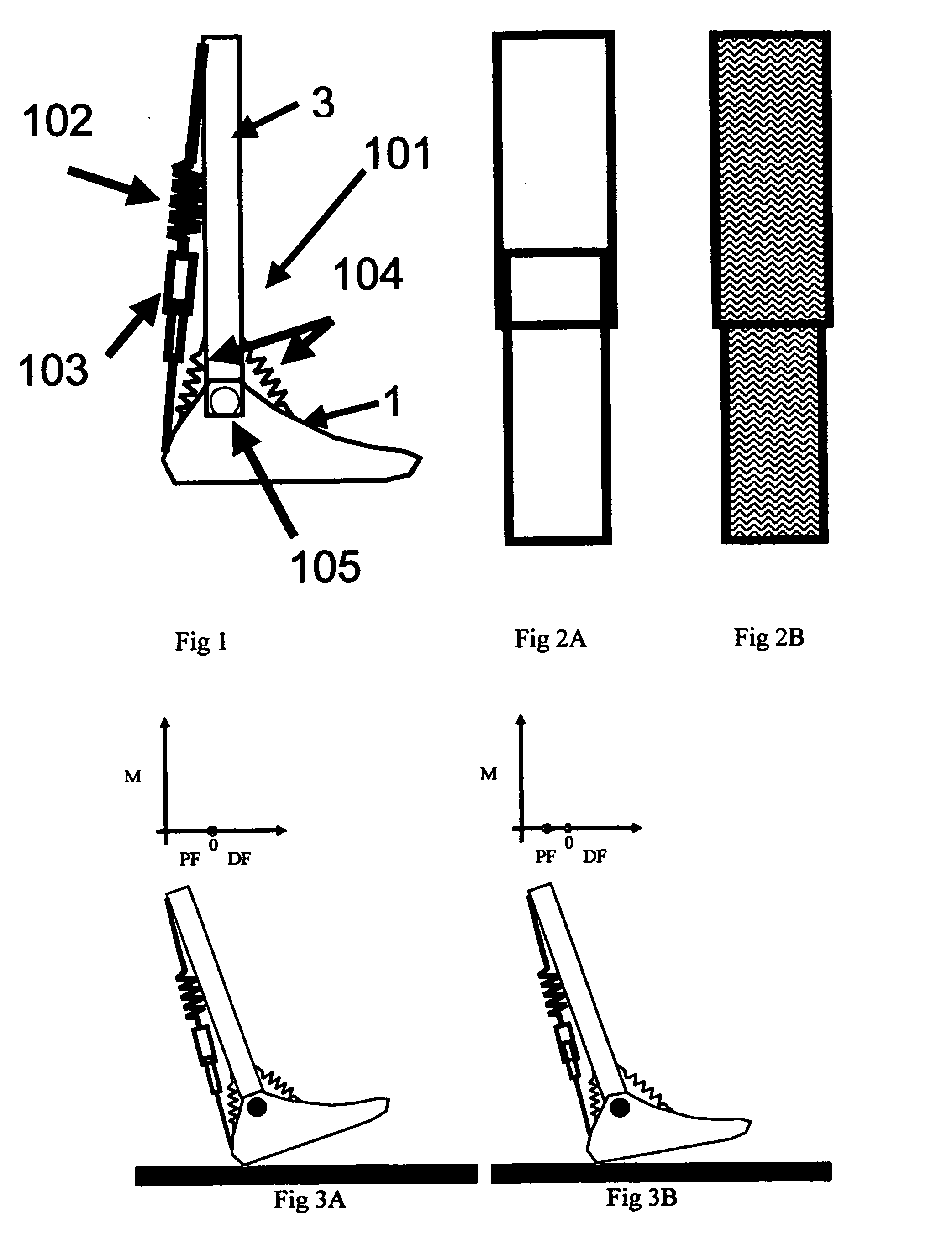

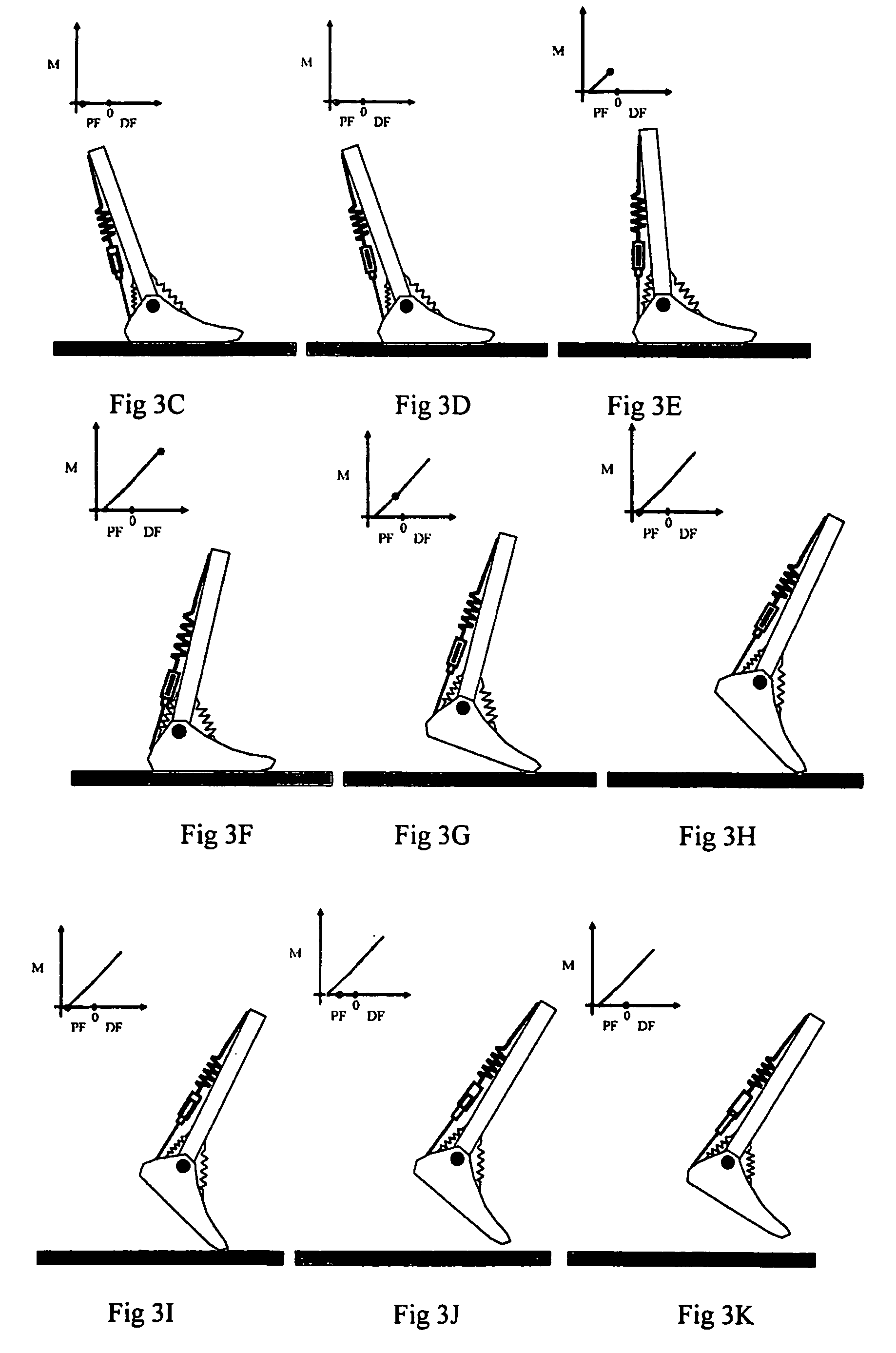

Equilibrium-point prosthetic and orthotic ankle-foot systems, devices, and methods of use

ActiveUS20100185301A1Reduce and prevent likelihoodWeaken energyArtificial legsDiseasePhysical medicine and rehabilitation

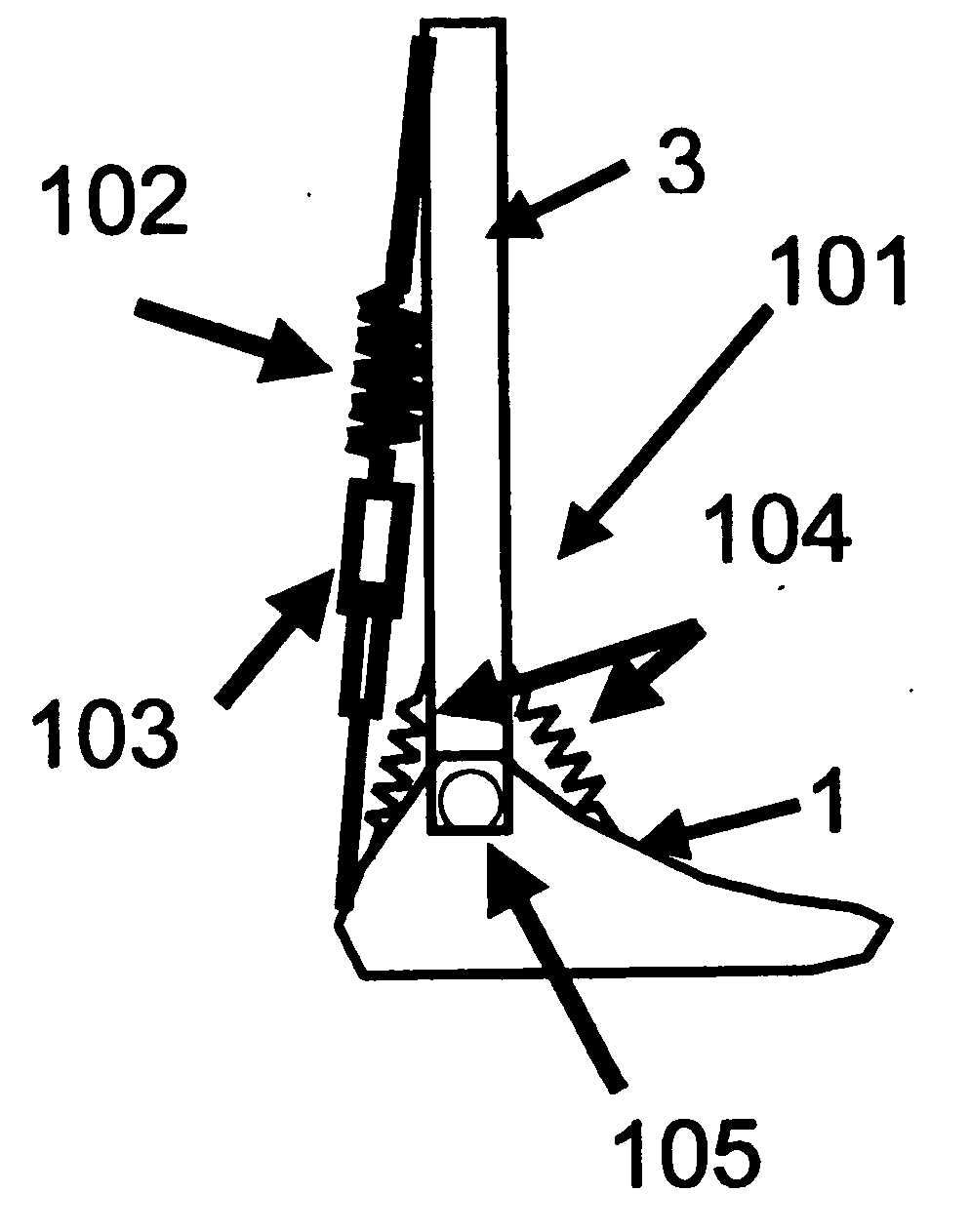

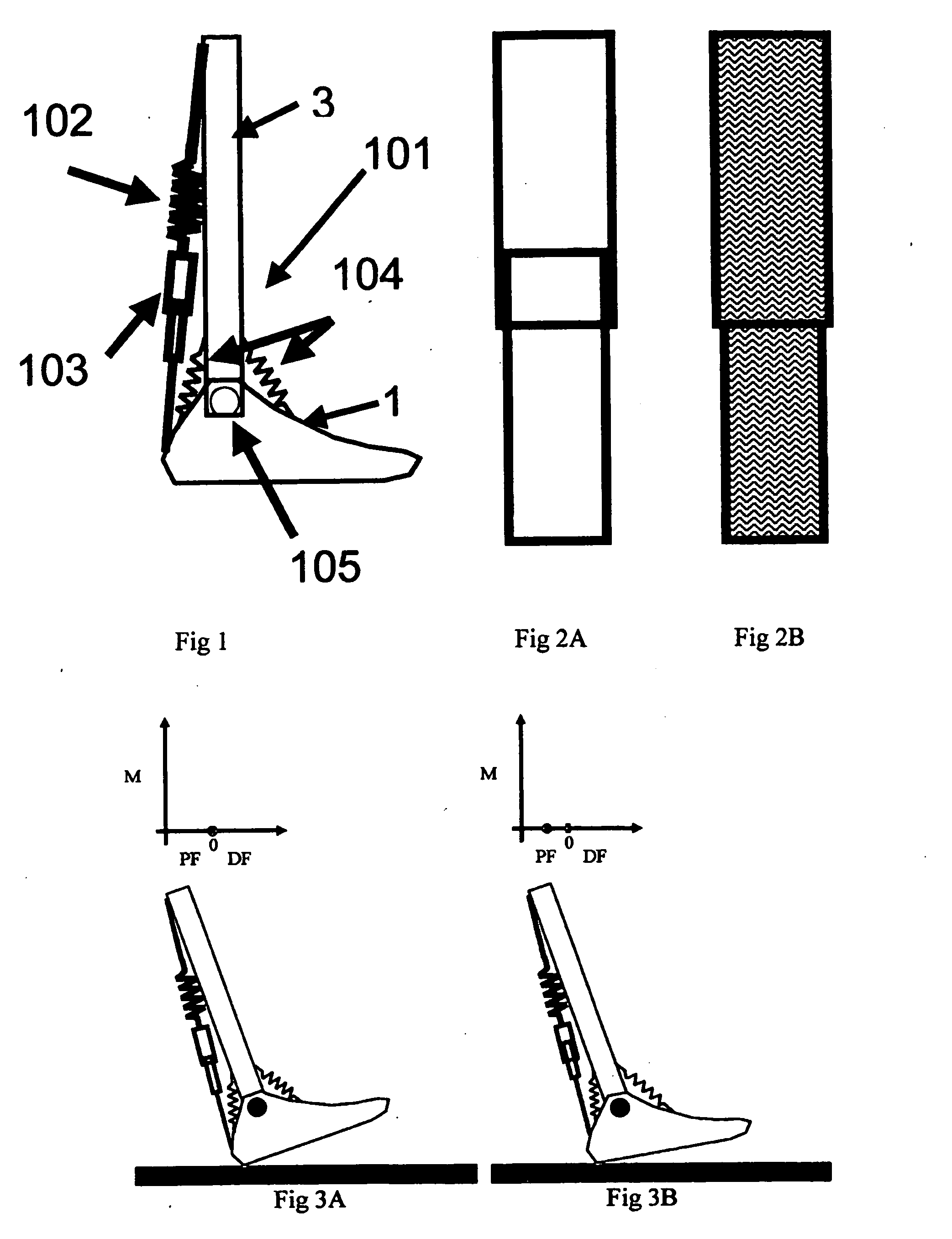

The present invention relates to a system for use in rehabilitation and / or physical therapy for the treatment of injury or disease. The system can enable an amputee to proceed over any surface without overbalancing. In particular the system is self-adapting to adjust the torque moment depending upon the motion, the extent of inclination, and the surface topography.

Owner:THE GOVERNMENT OF THE UNITED STATES OF AMERICA AS REPRESENTED BY THE DEPT OF VETERANS AFFAIRS +1

Optical and temperature feedbacks to control display brightness

ActiveUS20050088102A1Extend lamp lifeReduce the required powerElectrical apparatusStatic indicating devicesControl powerControl circuit

An illumination control circuit allows a user to set a desired brightness level and maintains the desired brightness level over temperature and life of a light source. The illumination control circuit uses a dual feedback loop with both optical and thermal feedbacks. The optical feedback loop controls power to the light source during normal operations. The thermal feedback loop overrides the optical feedback loop when the temperature of the light source becomes excessive.

Owner:POLARIS POWERLED TECH LLC

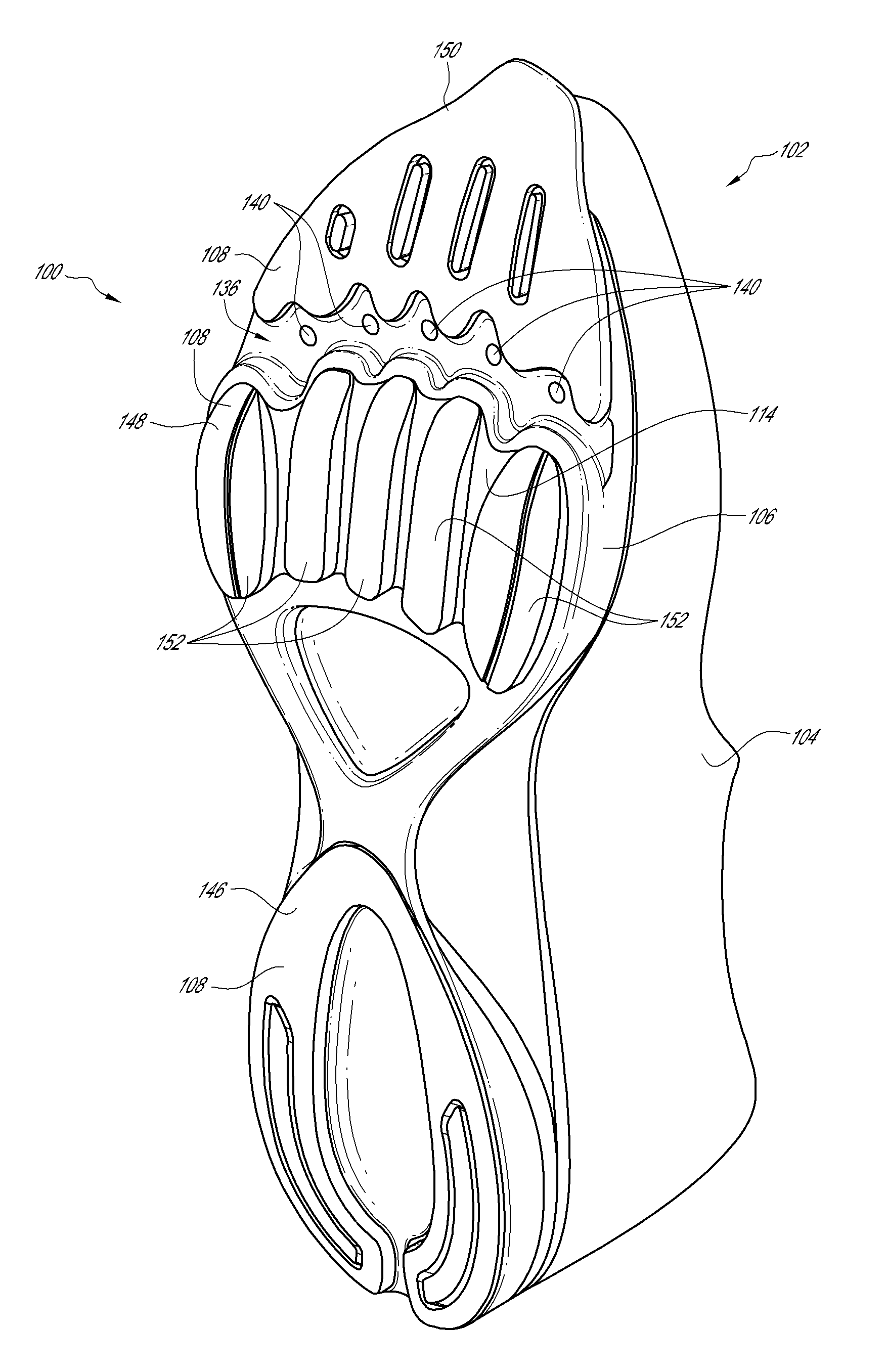

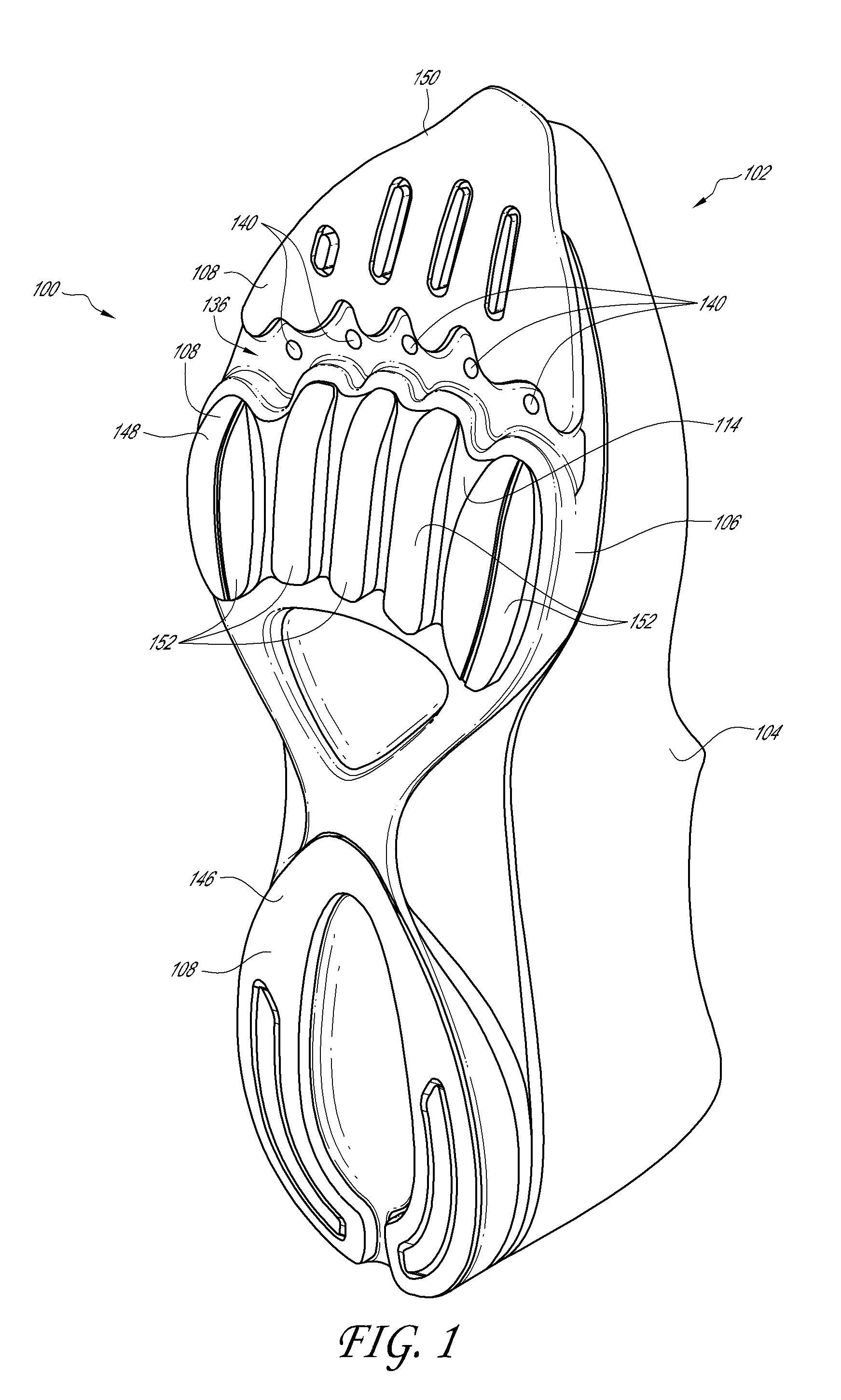

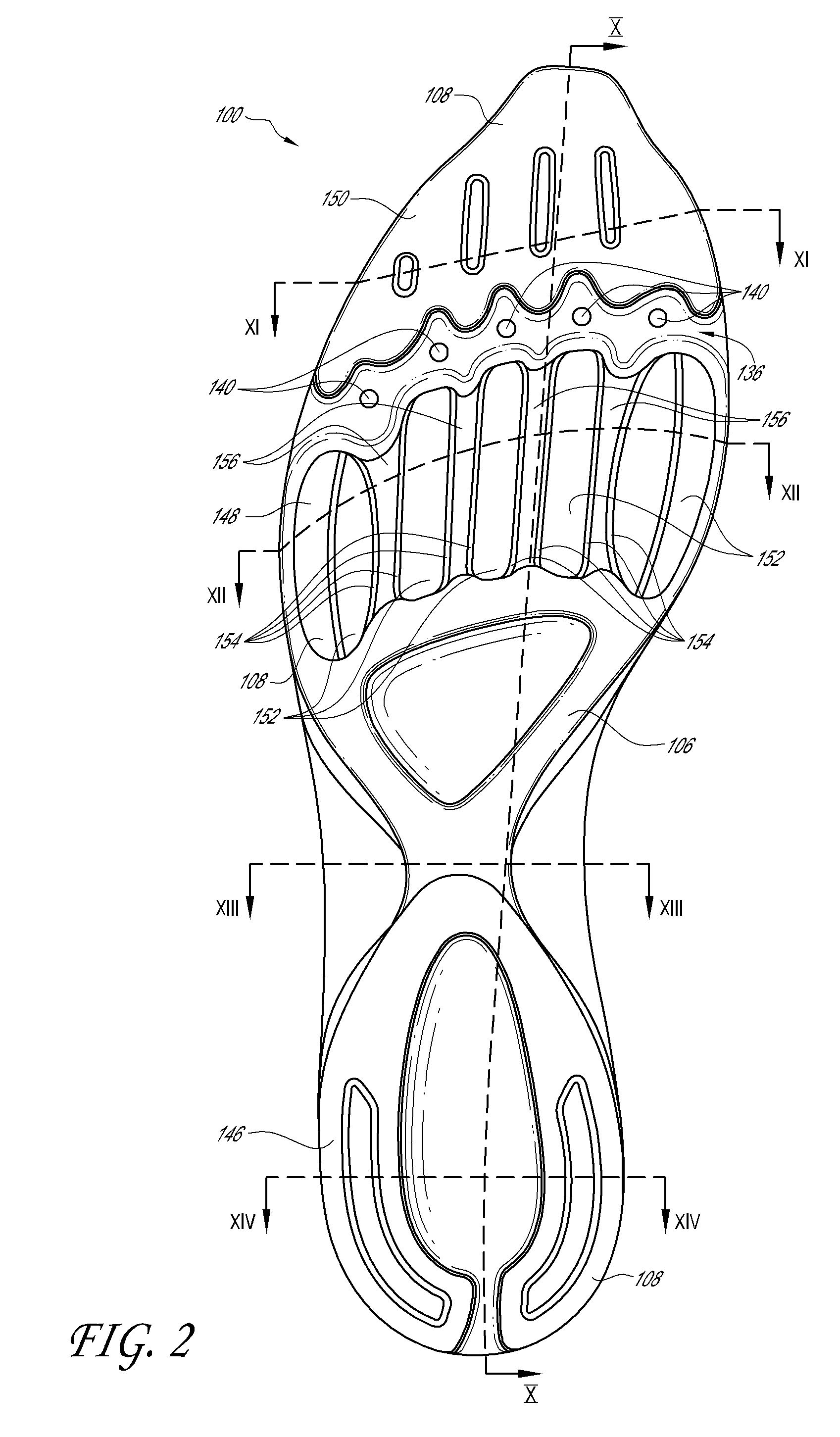

Shoe soles for shock absorption and energy return

A shoe sole can comprise one or more resiliently compressible elements received in a foundation and located by the foundation to underlie a portion of a foot, such as metatarsal heads, when the shoe is worn. The resiliently compressible element or elements can be shaped to reduce coupling of compression of adjacent regions of the resiliently compressible element. One or more plate elements can be positioned between the resiliently compressible elements and the foot, e.g. under the metatarsal heads. The plate elements can be separated from each other by spaces, such as slots, to reduce coupling of movement of adjacent plate elements. The plate elements can be elastically interconnected at the spaces between them. A plurality of lugs configured to contact the ground can be located on a lower surface of the foundation such that they are generally aligned with the plate elements. The plurality of lugs can be elastically interconnected.

Owner:NEWTON RUNNING CO INC

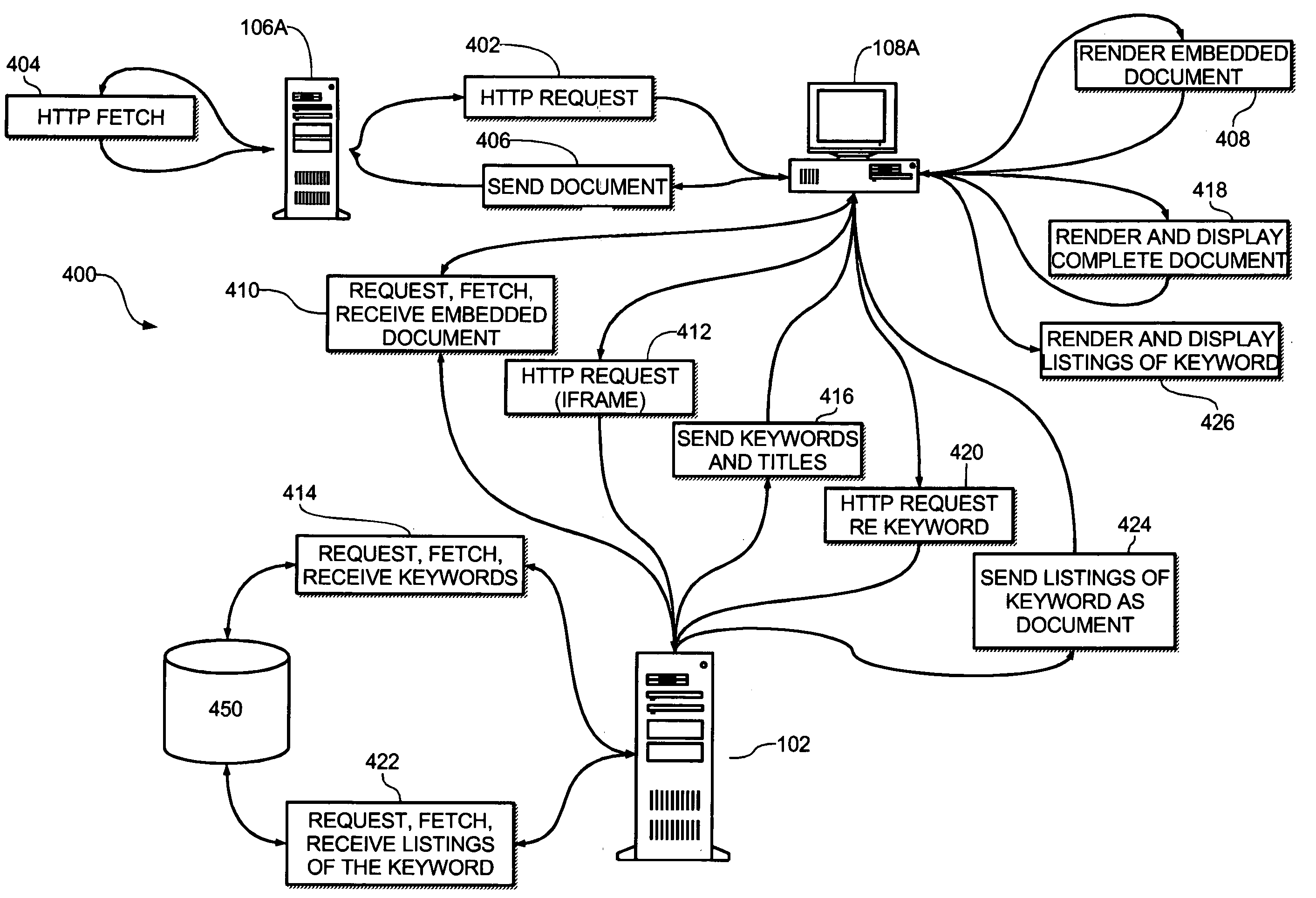

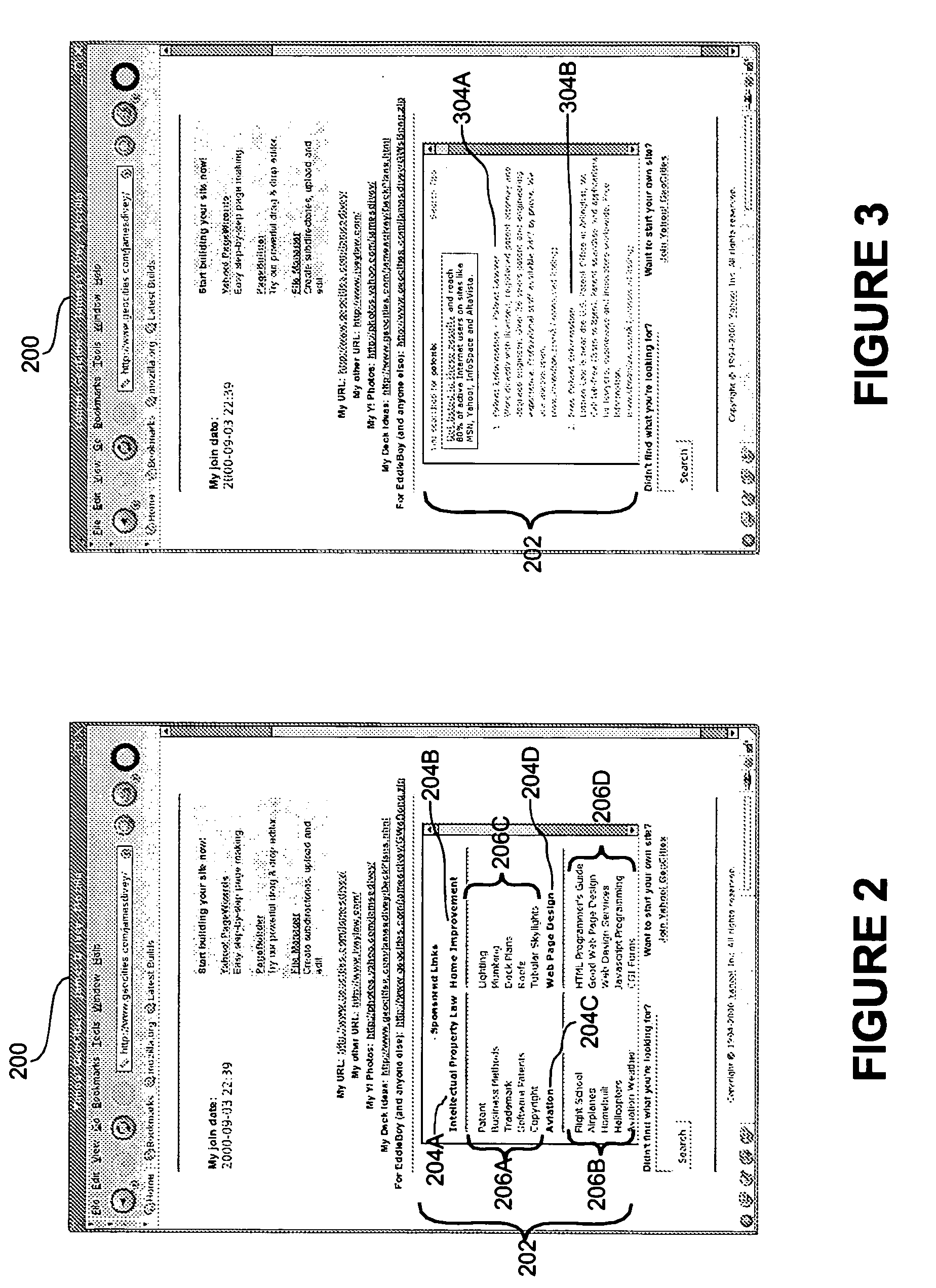

Efficiently spaced and used advertising in network-served multimedia documents

InactiveUS20060015401A1Efficiently presentedRaise the possibilityMarketingDocumentationNetwork service

A two-stage sponsored link mechanism is embedded in a Web page such that the amount of available information to the user is exponentially related to the space devoted to the sponsored links. In the first stage, a server provides categories and topics, in the form of searchable keywords, for inclusion in the Web page. In the second stage, the user clicks on one of the keywords under one of the categories to generate a search request for search listings associated with the keyword. The server returns a number of search listings selected according to the value attributed to each search listing by its owner. By providing multiple topics to the user, the likelihood the user will find information of interest, and thus access of such adjunct information, is significantly increased.

Owner:OATH INC

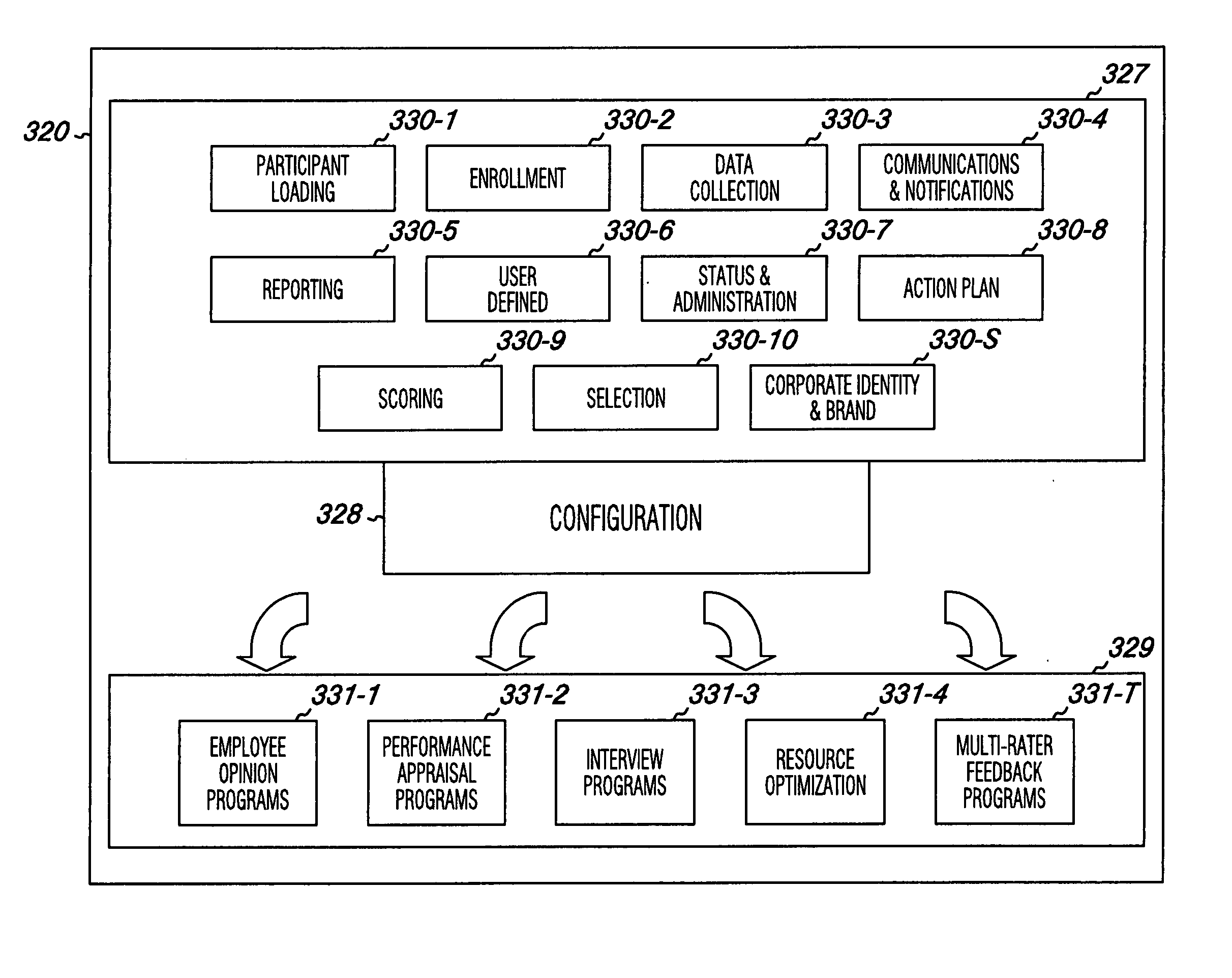

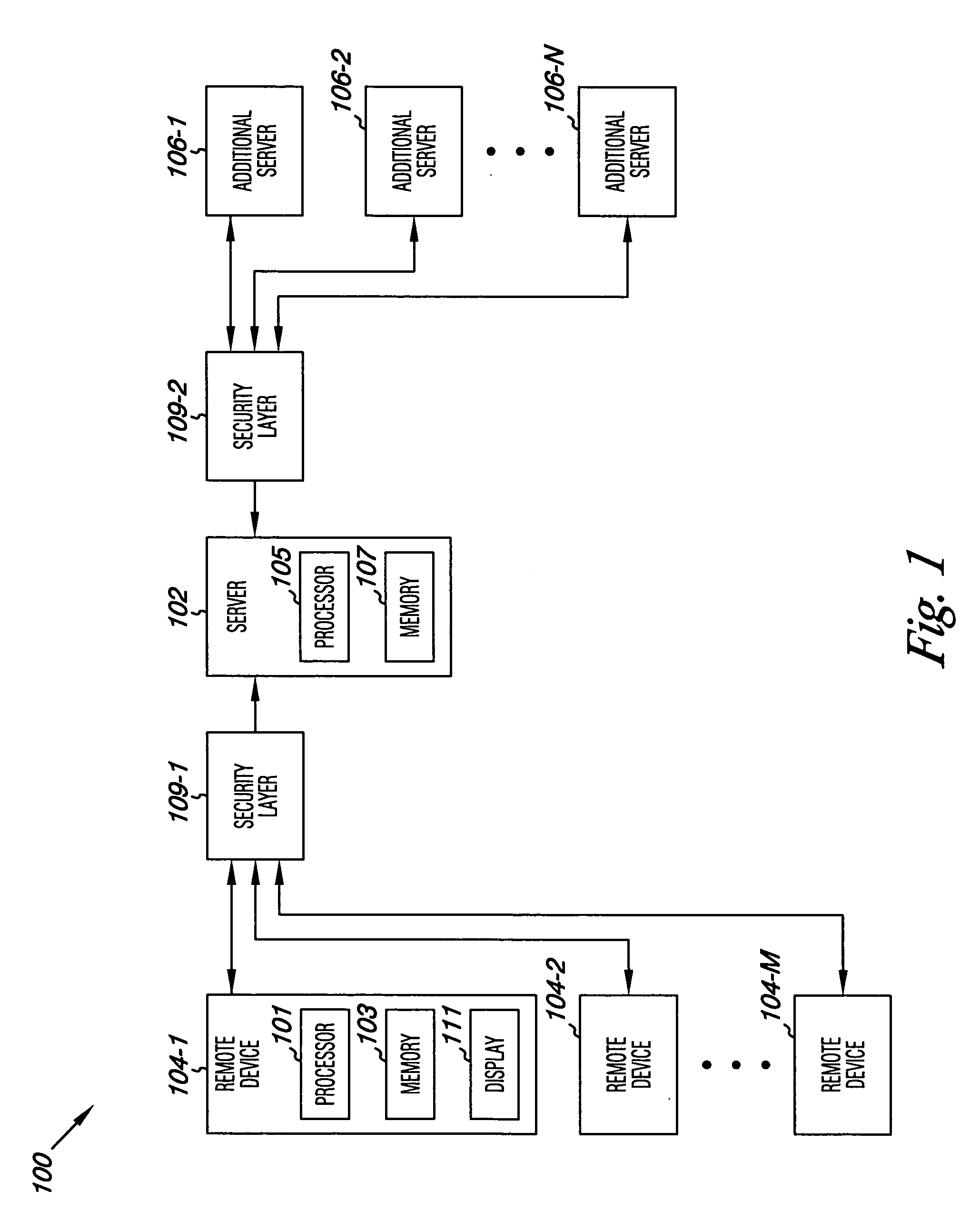

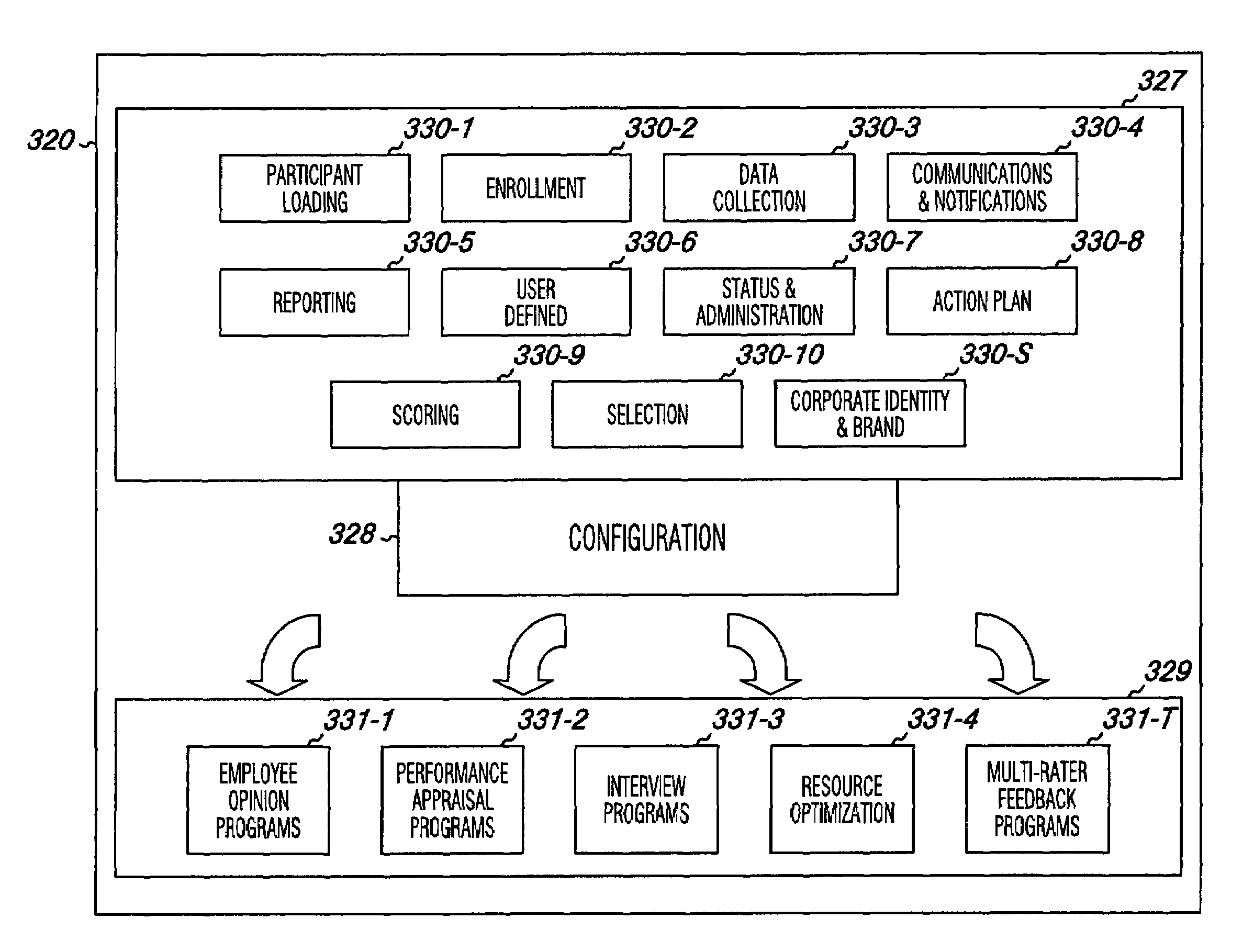

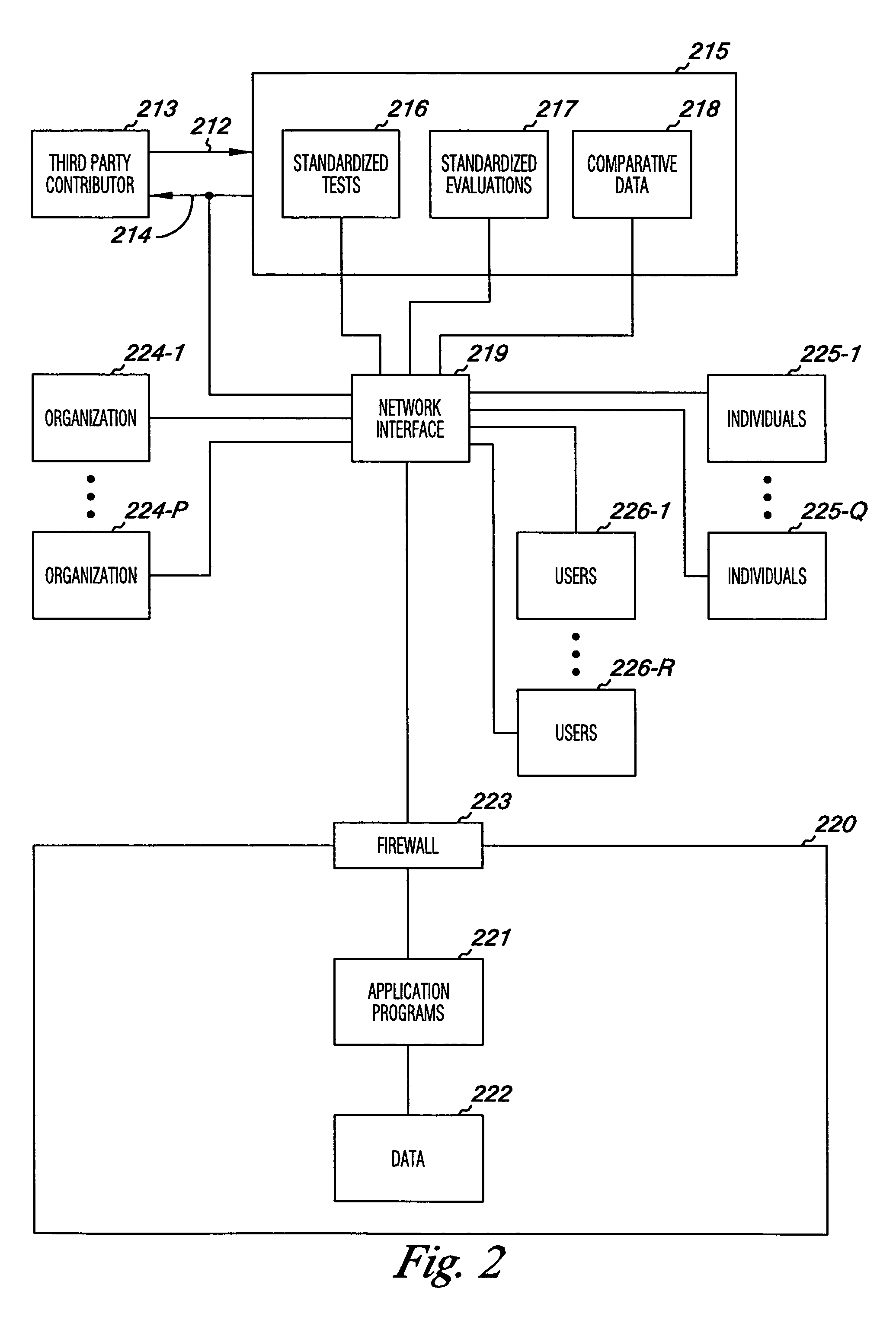

Human resource assessment

InactiveUS20060031115A1High levelImprove returnHardware monitoringResourcesResource assessmentProgram instruction

Methods, devices, and systems are provided for human resource assessment. A resource planning device includes a processor, a memory, and a user interface coupled to one another. The device includes program instructions storable in the memory and executable by the processor to present, in a selectable configuration, organization specific human resource content after processing according to a selectable set of business rules. The selectable set of business rules are process neutral, brand neutral, and assessment neutral between various organizations. The device can track input to the organization specific content and analyze the input.

Owner:DATA SOLUTIONS

Knowledge discovery agent system and method

ActiveUS20060112029A1Return on investmentIncrease valueChaos modelsNon-linear system modelsComputerized systemSoftware agent

A software agent system is provided that continues to learn as it utilizes natural language processors to tackle limited semantic awareness, and creates superior communication between disparate computer systems. The software provides intelligent middleware and advanced learning agents which extend the parameters for machine agent capabilities beyond simple, fixed tasks thus producing cost savings in future hardware and software platforms.

Owner:DIGITAL REASONING SYST

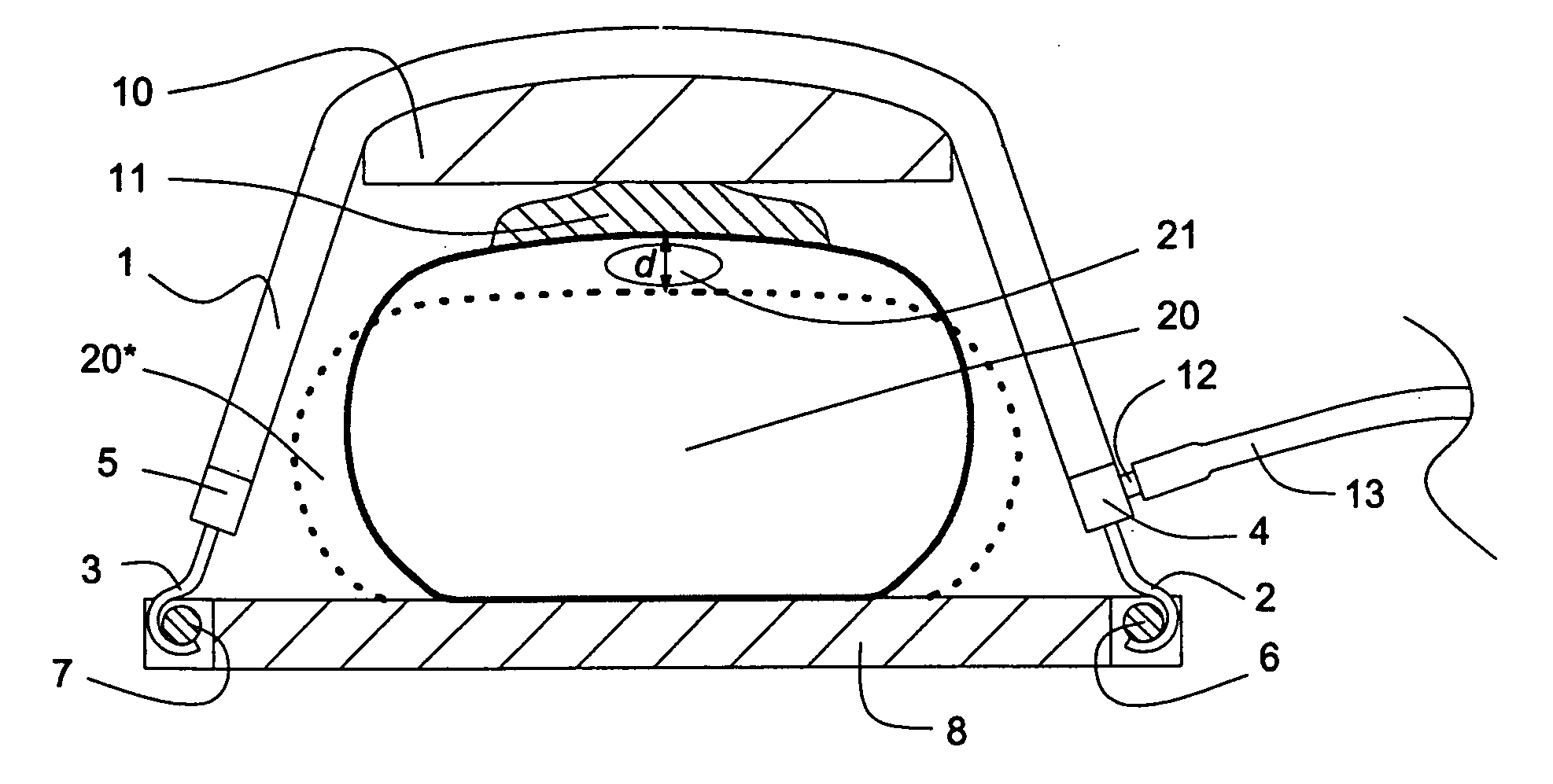

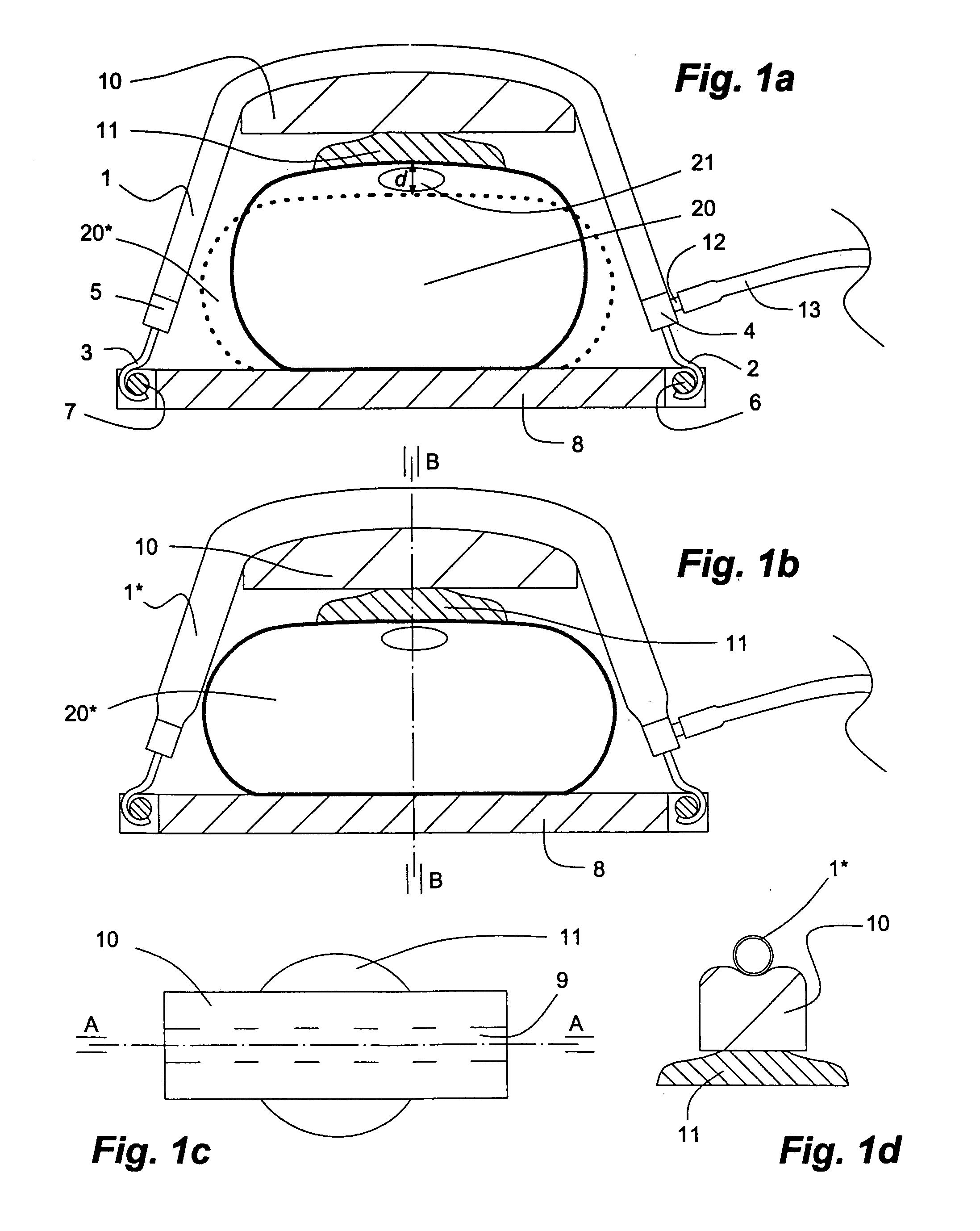

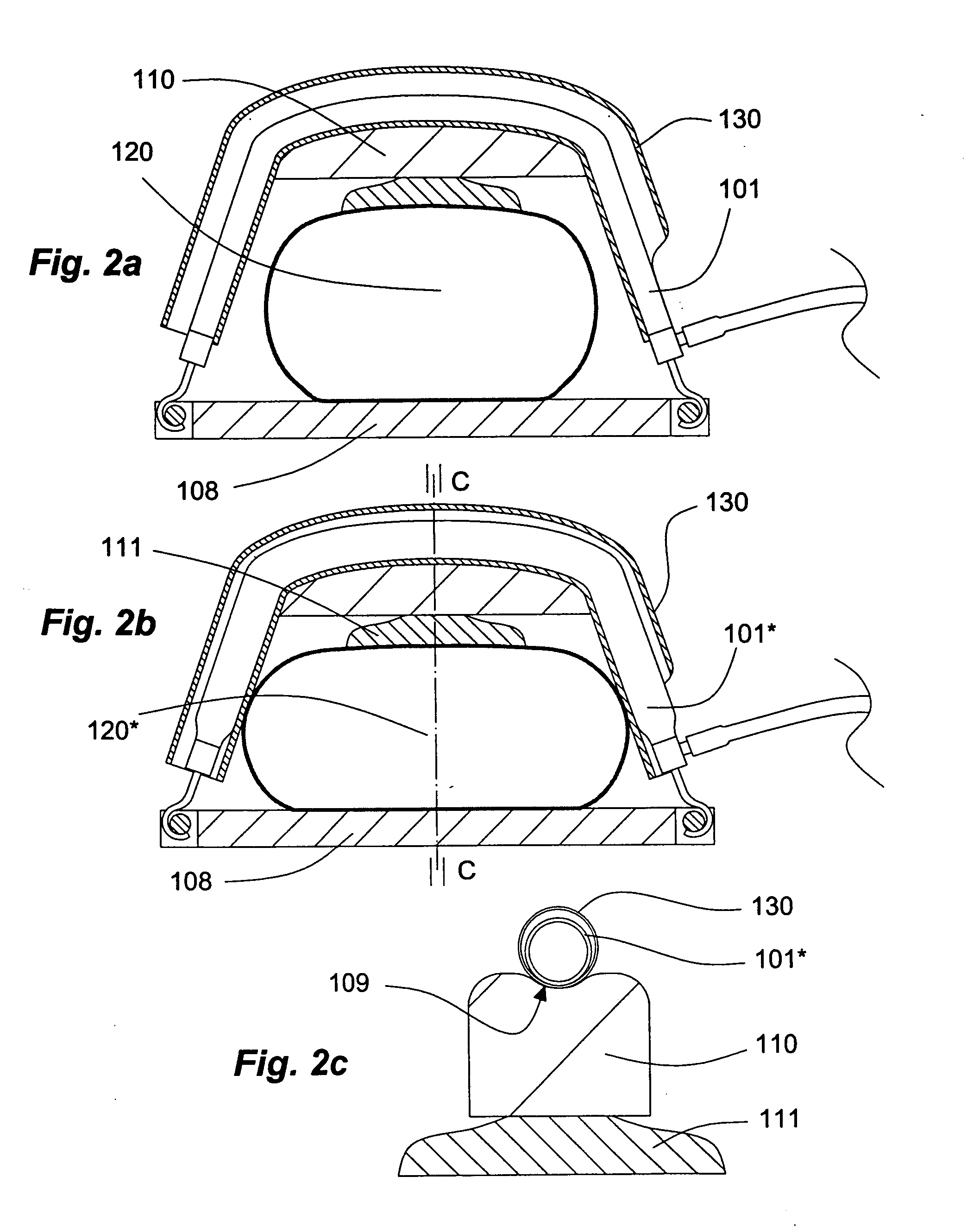

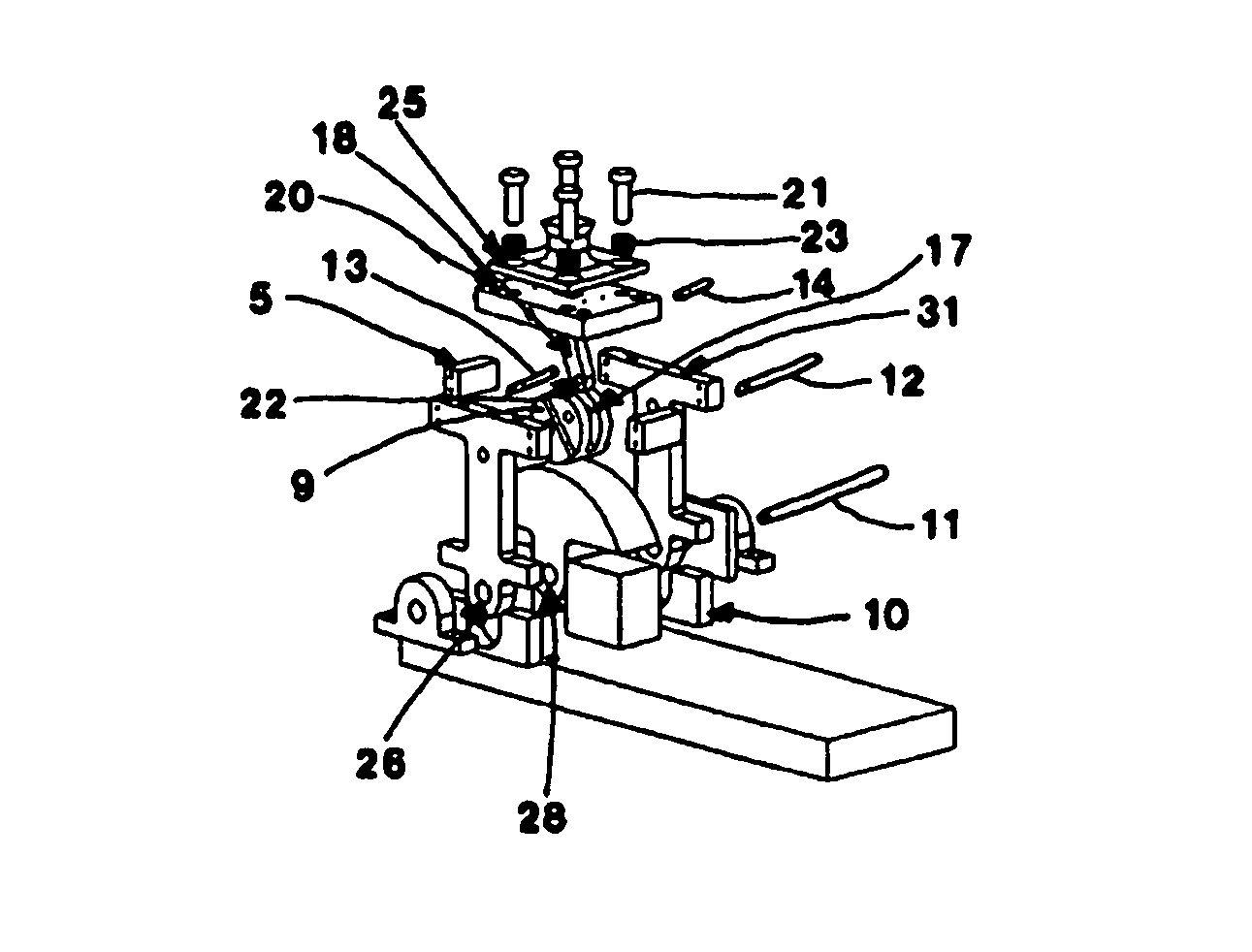

Gas-driven chest compression apparatus

InactiveUS20100004572A1Improve returnSimple drive controlElectrotherapyIron-lungsEmergency medicineCPR - Cardiopulmonary resuscitation

A gas-driven chest compression apparatus for cardiopulmonary resuscitation (CPR) comprises a flexible pneumatic actuator, capable of axial contraction when fed with a pressurized driving gas, and means for controlling the contraction thereof. Also disclosed are methods of providing chest compressions to a patient by means of a CPR apparatus comprising actuator(s) of this kind, and a corresponding use of the actuator.

Owner:PHYSIO CONTROL INC

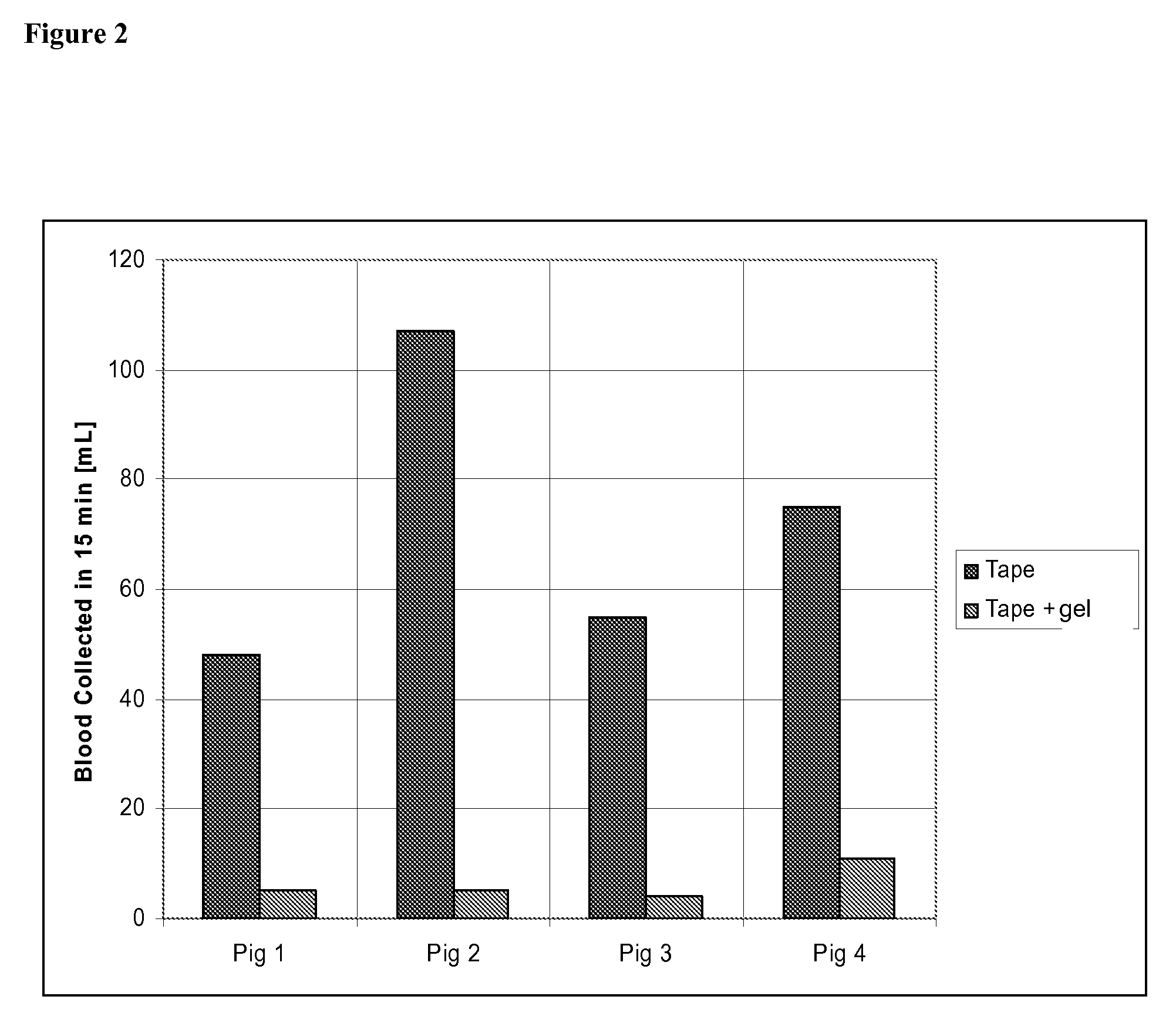

Perfusive Organ Hemostasis

InactiveUS20080181952A1Flow of bloodImprove returnAntibacterial agentsOrganic active ingredientsSurgical operationNephron

Disclosed are compositions, methods and kits to control bleeding through the use of an internal occluder based on polymeric solutions, including use of reverse thermosensitive polymers in nephron-sparing surgeries, which produces a completely bloodless surgical field, allowing speedy resection. In certain embodiments, after a certain amount of time, the flow gradually resumes, with no apparent adverse consequences to the kidney. In certain embodiments, return of blood flow may be accelerated by cooling the kidney. The compositions, methods and kits for perfusive organ hemostasis can also be used to simplify or to enable other organ surgeries or interventional procedures, including liver surgery, prostate surgery, brain surgery, surgery of the uterus, spleen surgery and any surgery on any highly vascularized organs.

Owner:GENZYME CORP +1

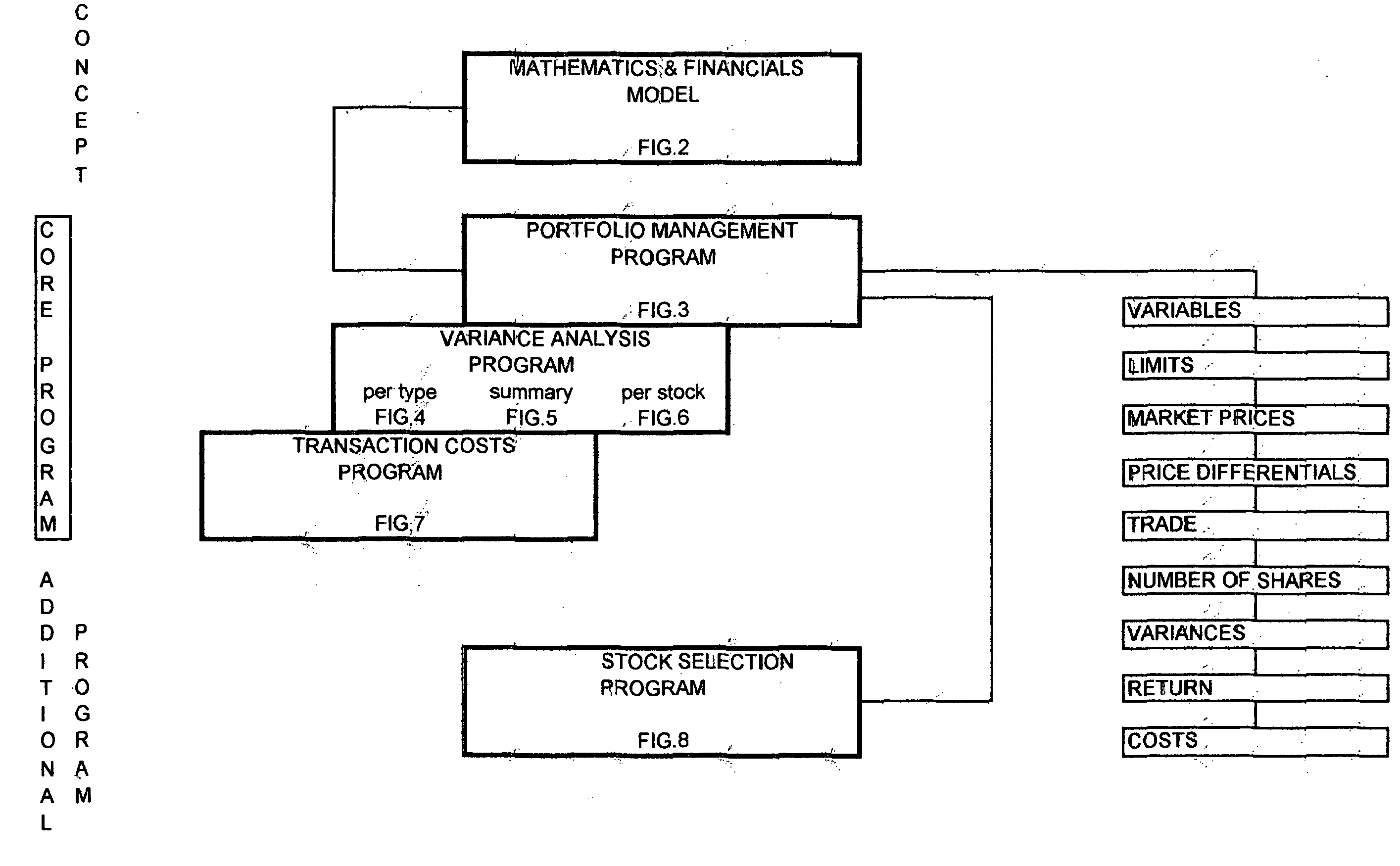

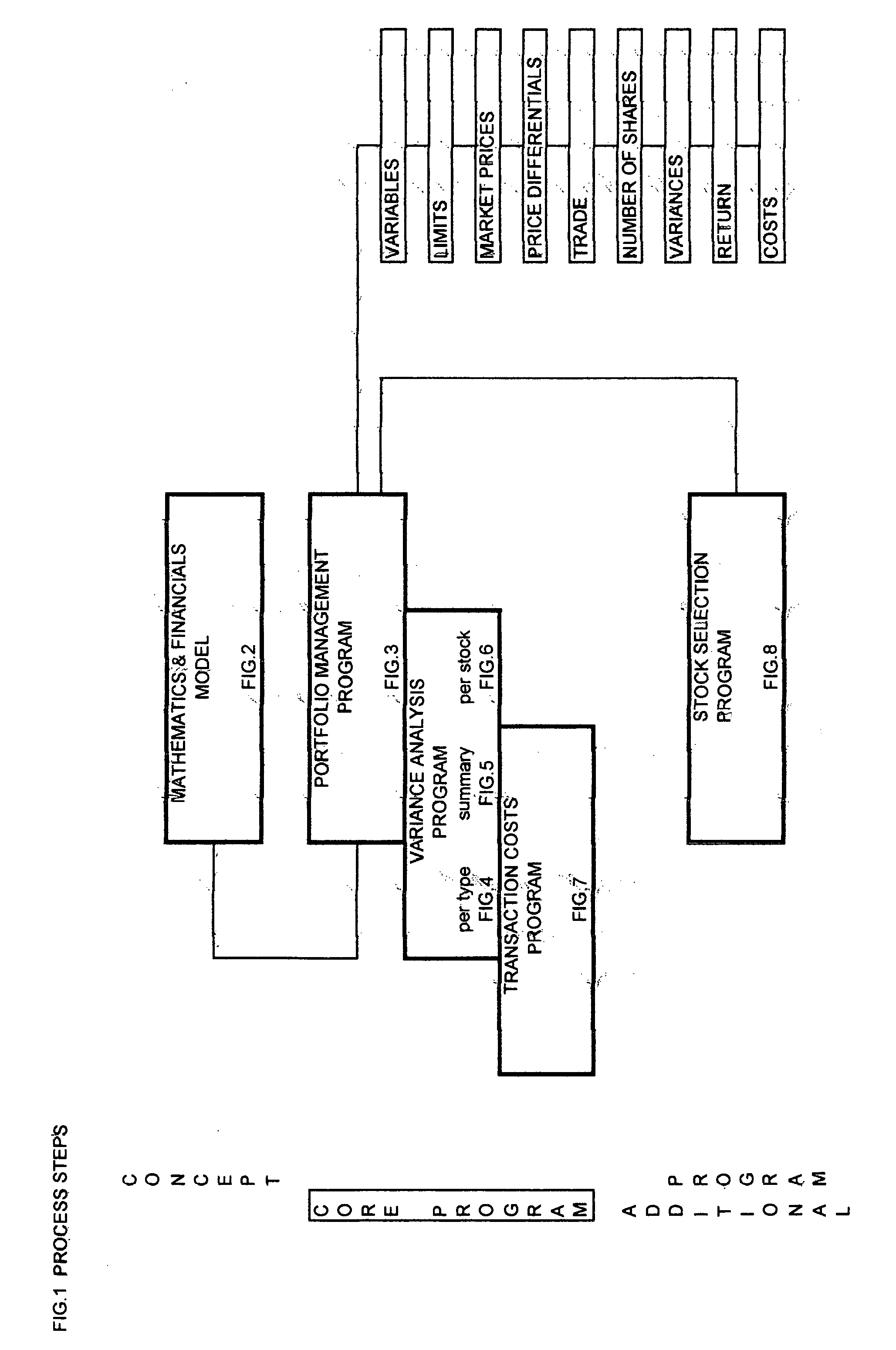

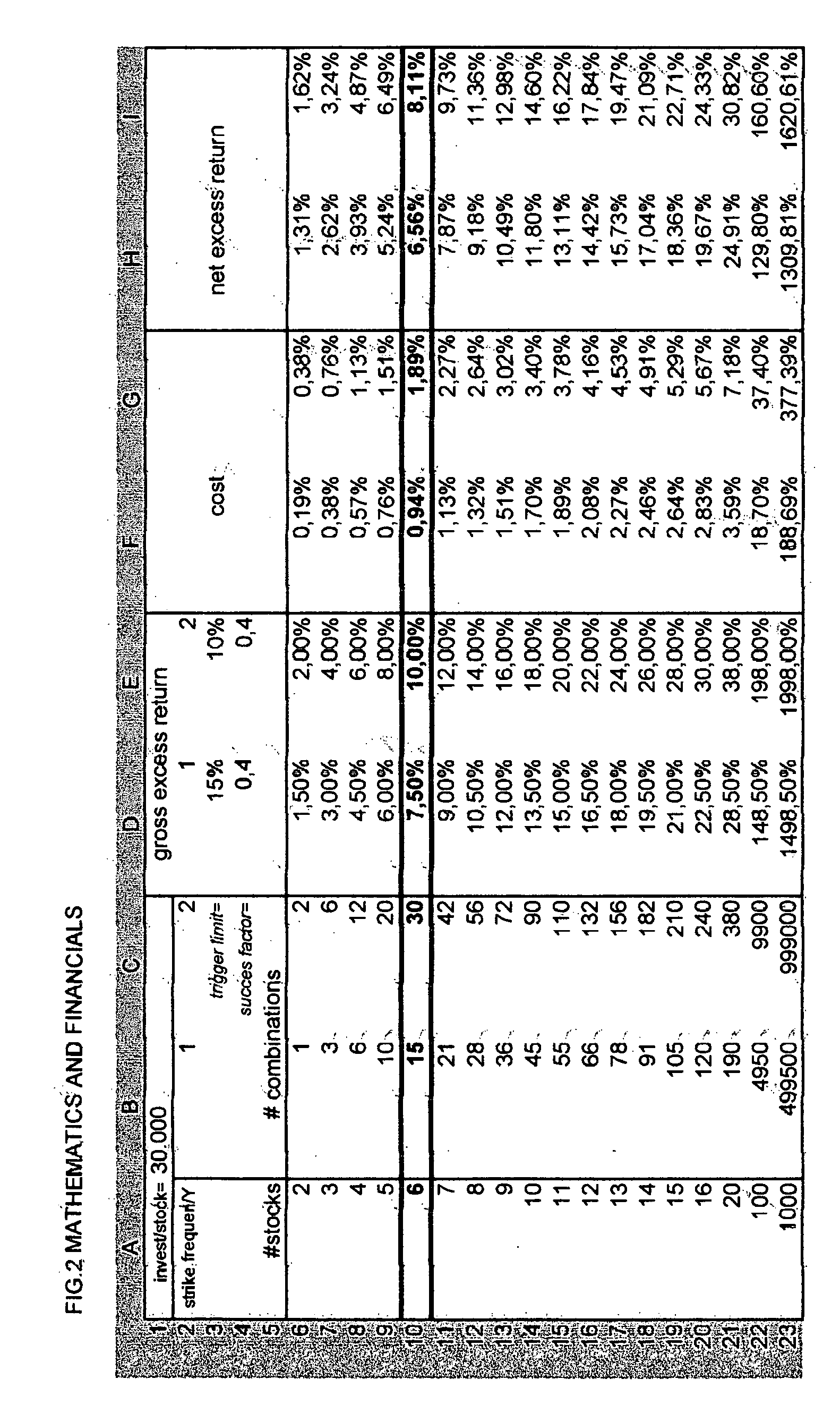

System for optimizing the return of an investment portfolio, using a method of multiple share combinations

InactiveUS20050149422A1Improve returnIncrease the number ofFinanceSpecial data processing applicationsElectronic formCombined method

Owner:VAN LIER EDOUARD

Equilibrium-point prosthetic and orthotic ankle-foot systems and devices

ActiveUS8597369B2Reduce and prevent likelihoodWeaken energyArtificial legsDiseasePhysical medicine and rehabilitation

The present invention relates to a system for use in rehabilitation and / or physical therapy for the treatment of injury or disease. The system can enable an amputee to proceed over any surface without overbalancing. In particular the system is self-adapting to adjust the torque moment depending upon the motion, the extent of inclination, and the surface topography.

Owner:U S GOVERNMENT REPRESENTED BY THE DEPT OF VETERANS AFFAIRS +1

Advanced memory device having improved performance, reduced power and increased reliability

An advanced memory having improved performance, reduced power and increased reliability. A memory device includes a memory array, a receiver for receiving a command and associated data, error control coding circuitry for performing error control checking on the received command, and data masking circuitry for preventing the associated data from being written to the memory array in response to the error control coding circuitry detecting an error in the received command. Another memory device includes a programmable preamble. Another memory device includes a fast exit self-refresh mode. Another memory device includes auto refresh function that is controlled by the characteristic device. Another memory device includes an auto refresh function that is controlled by a characteristic of the memory device.

Owner:GLOBALFOUNDRIES US INC

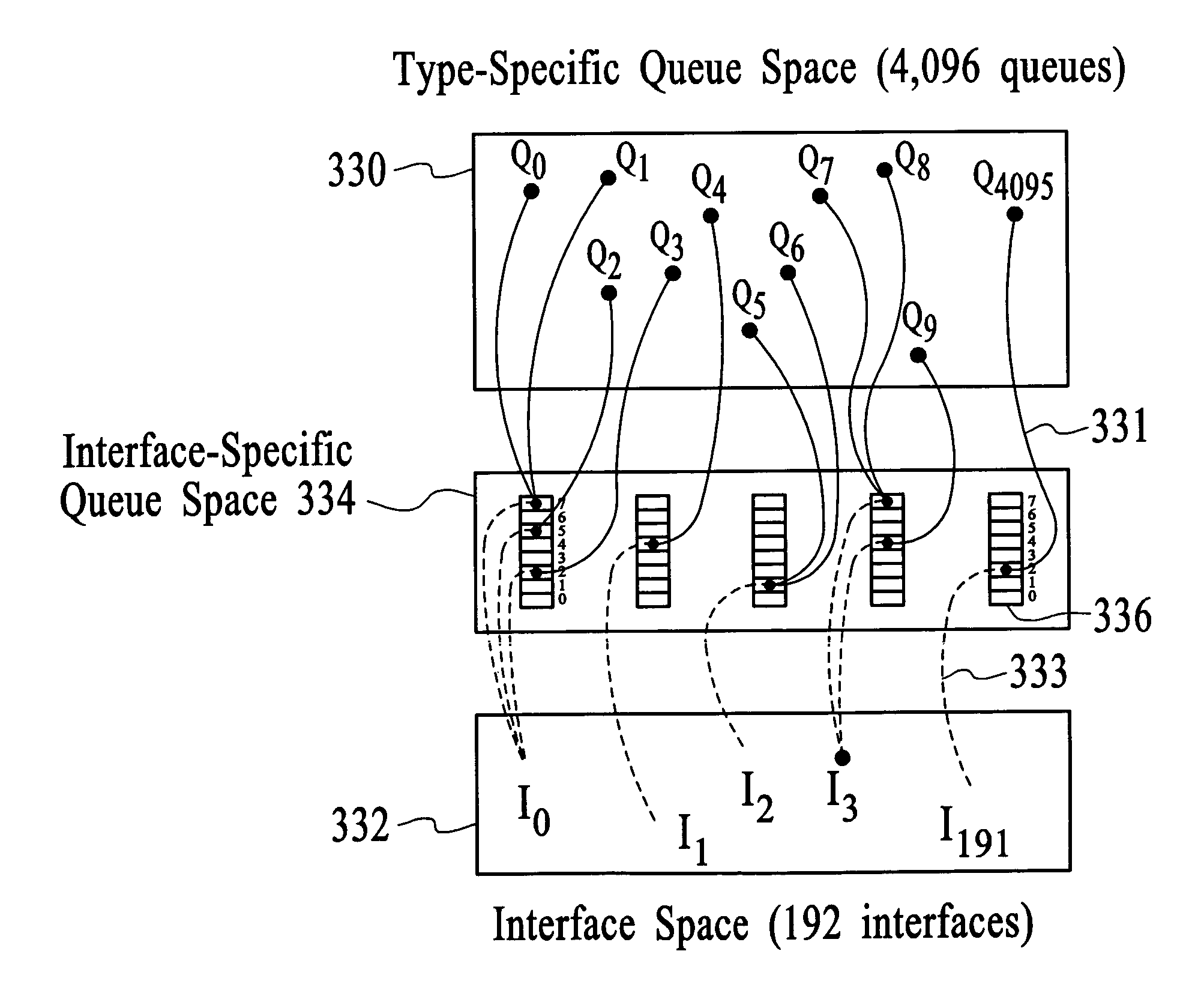

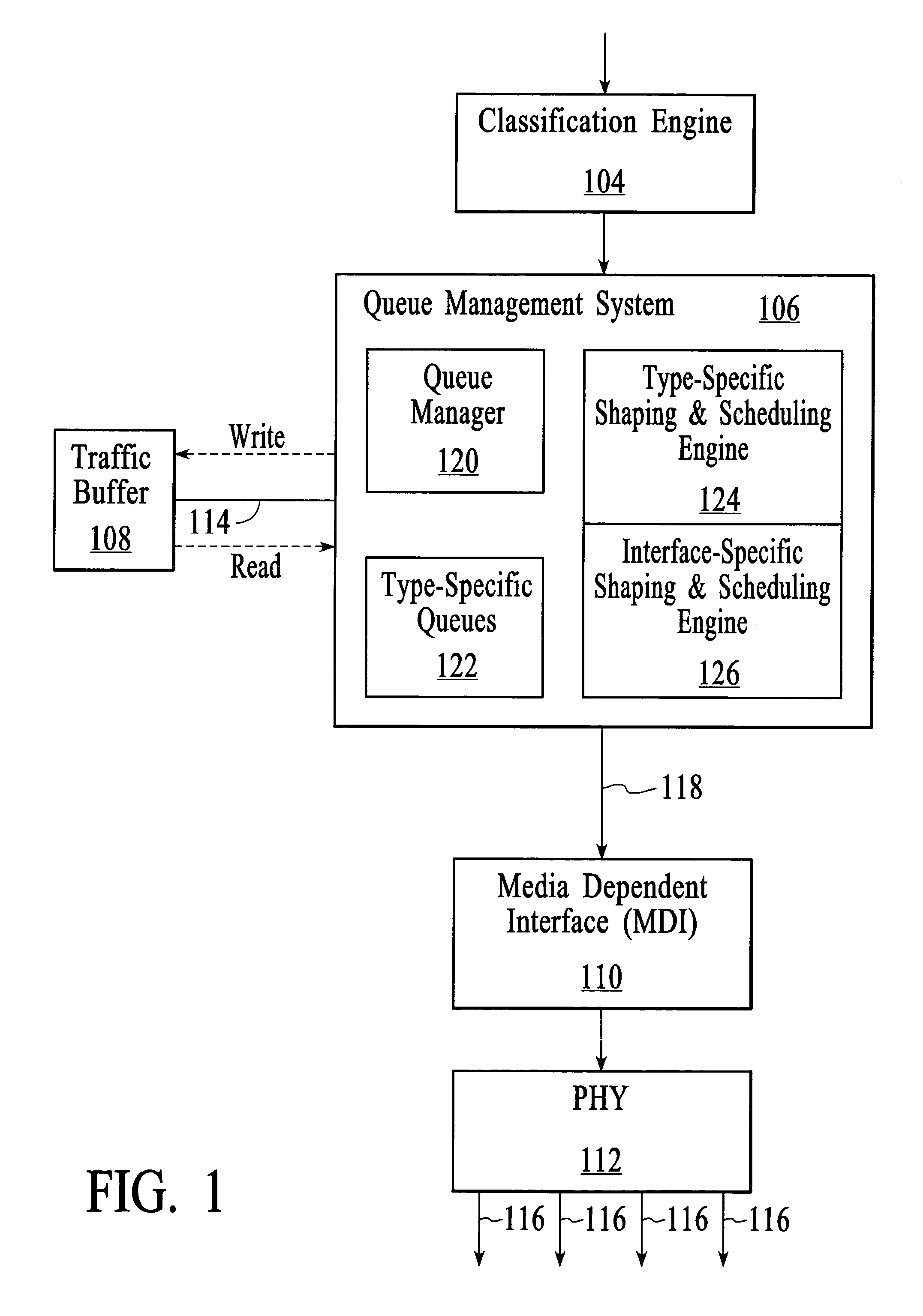

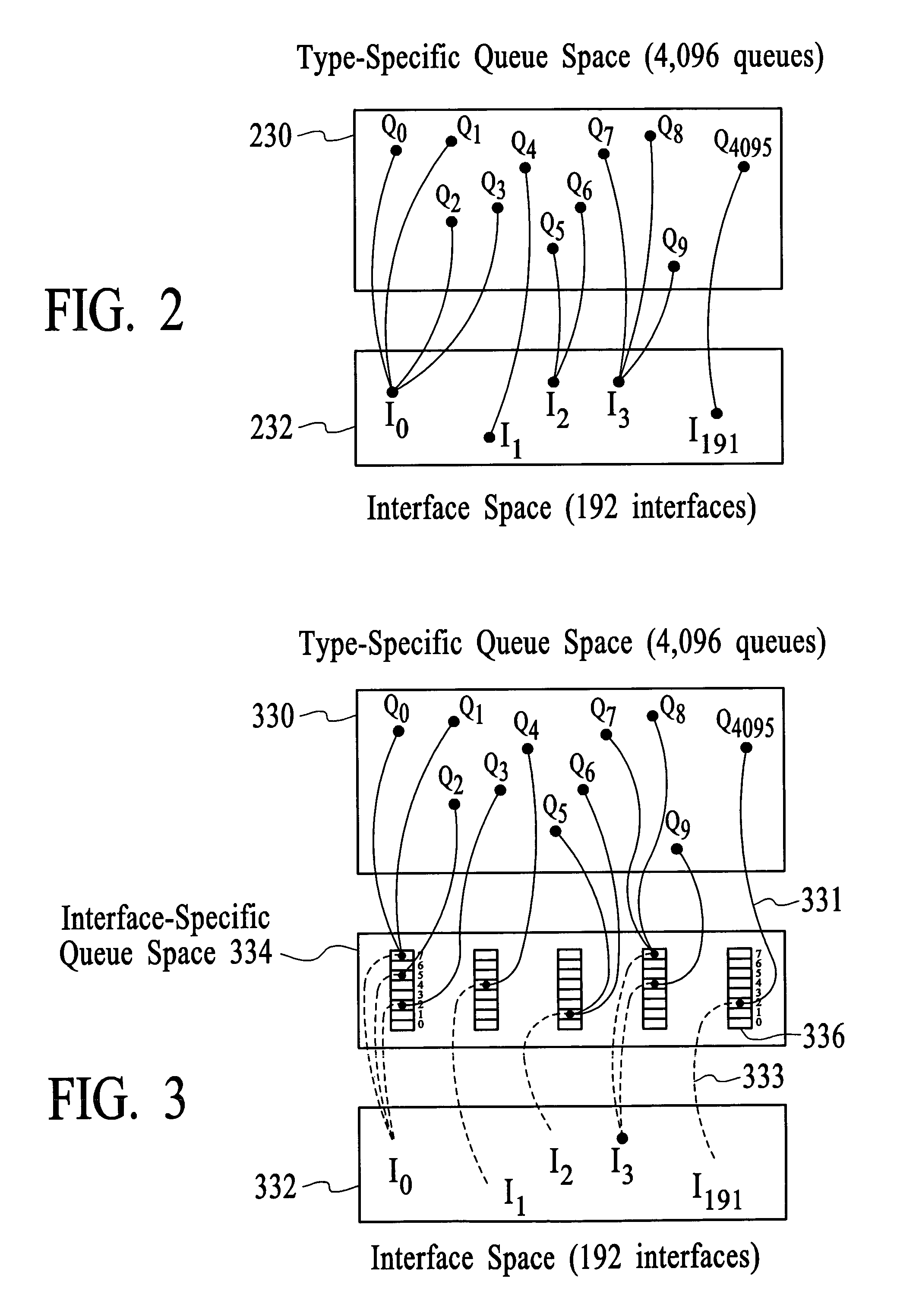

Flexible multilevel output traffic control

ActiveUS7474668B2Easy to adaptImprove the level ofError preventionFrequency-division multiplex detailsNetwork packetRate shaping

A two stage rate shaping and scheduling system and method is implemented to control the flow of traffic to at least one output interface. The system and method involves initially queuing incoming packets into type-specific queues and applying individual rate shaping rules to each queue. A first stage arbitration is performed to determine how traffic is queued from the type-specific queues to interface-specific queues. Packets that win arbitration and pass the applied rate shaping rules are queued in interface-specific queues. Rate shaping rules are applied to the interface-specific queues. The interface-specific queues are further distinguished by priority and priority-specific and interface-specific rate shaping rules are applied to each queue. A second stage arbitration is performed to determine how different priority traffic that is targeting the same output interface is dequeued in response to interface-specific requests.

Owner:RPX CORP +1

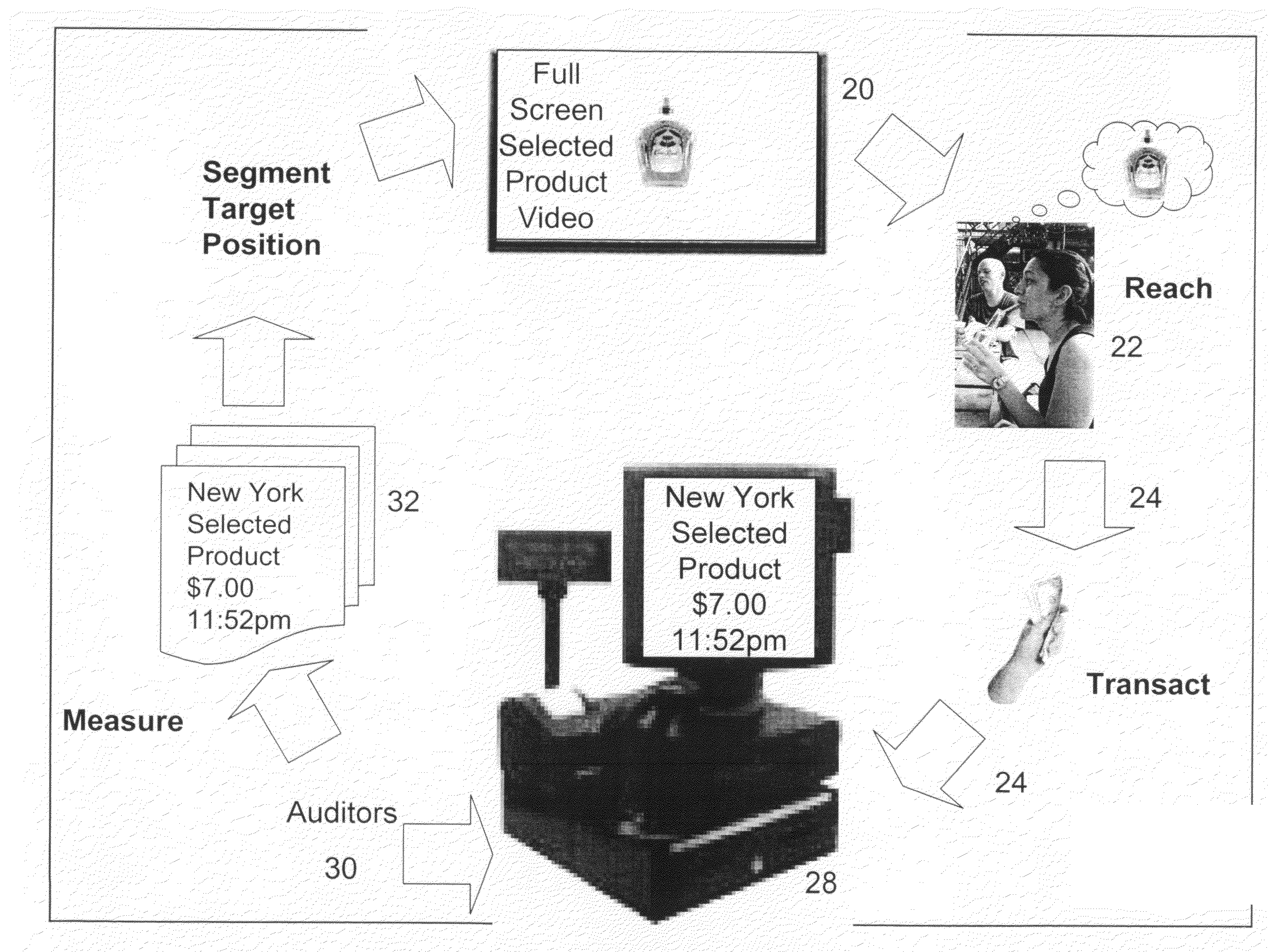

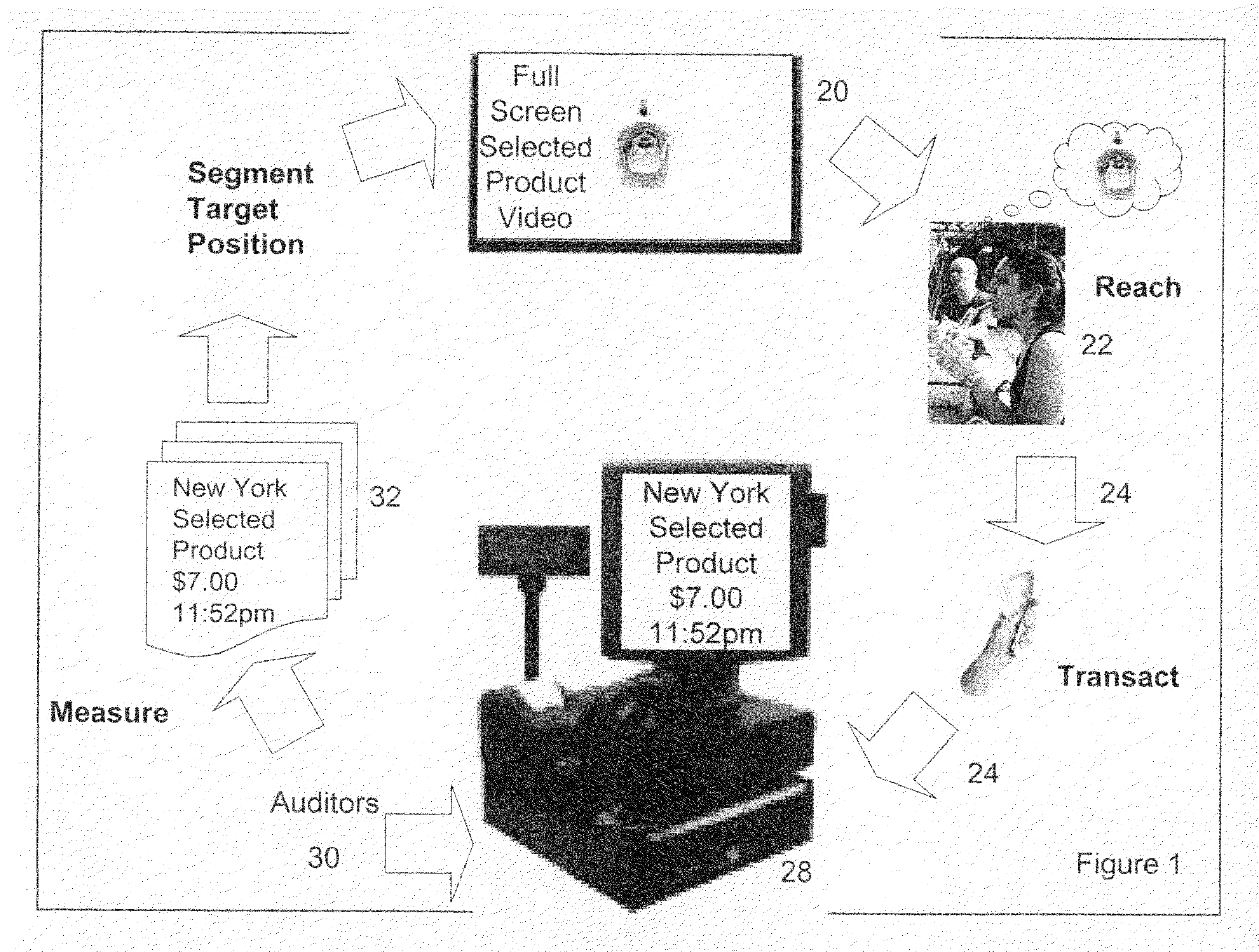

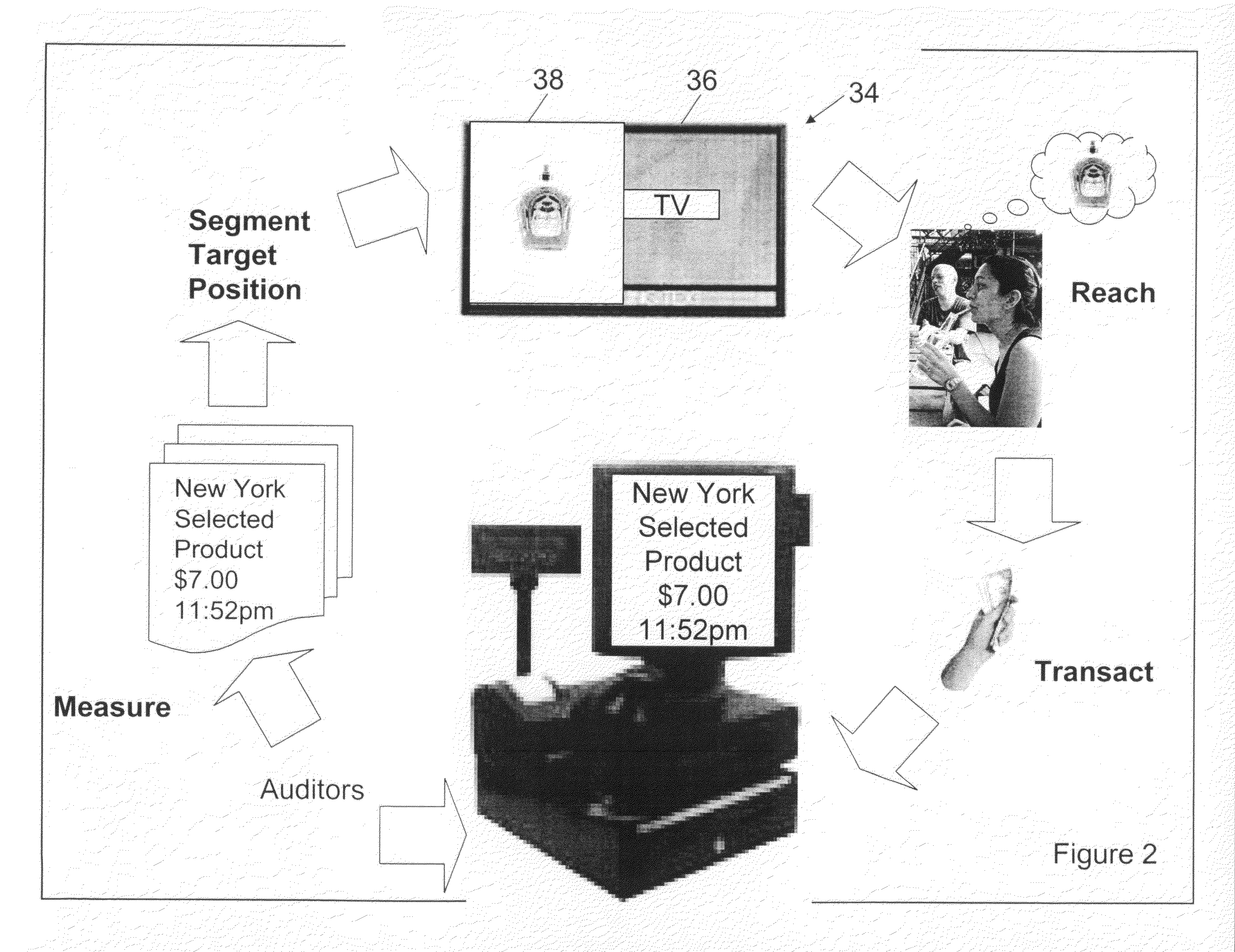

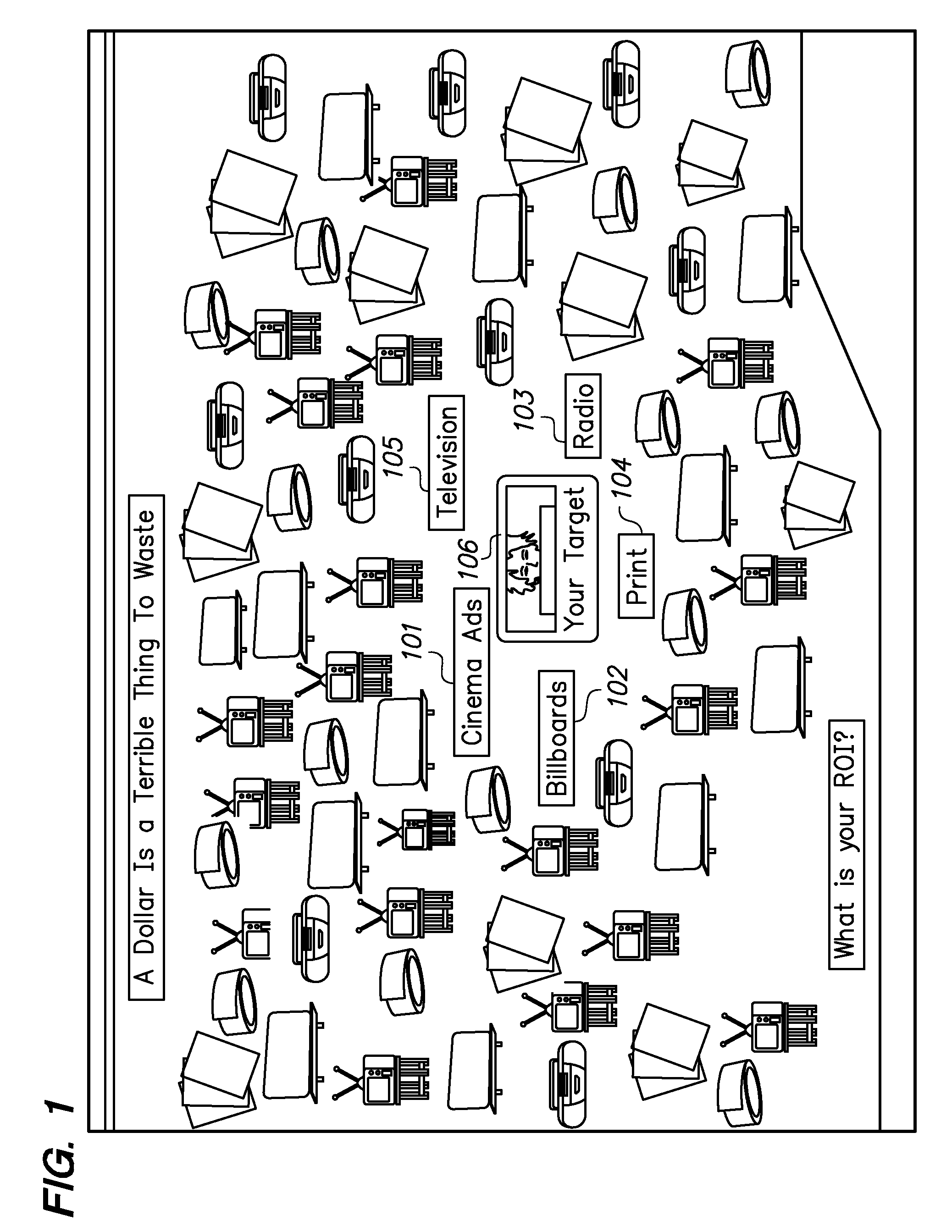

System for optimizing on-premises advertisements

InactiveUS20080230604A1Increase choiceImprove returnAdvertisementsVisual presentationEngineeringPoint of sale

A system for optimizing on-premises advertising, for example, at retail food and / or beverage establishments, such as bars, restaurants, night clubs, sports stadiums and other on-premise retail sites. The optimization is based upon on-premise sales data which includes point-of-sale (POS) data and may also take into account waste, spoilage, theft etc (“collectively “native sales data”). In one embodiment of the invention, the system is able to optimize which products are advertised based upon native sales data. In other embodiments of the invention, the system is able to determine the effectiveness of impulse advertisements for the selected products as well as the timing of the impulse advertisements in order to increase sales of selected products and increase the profitability of the retail establishment and improve the return on impulse ad costs.

Owner:CASTLEPATH GRP LDC

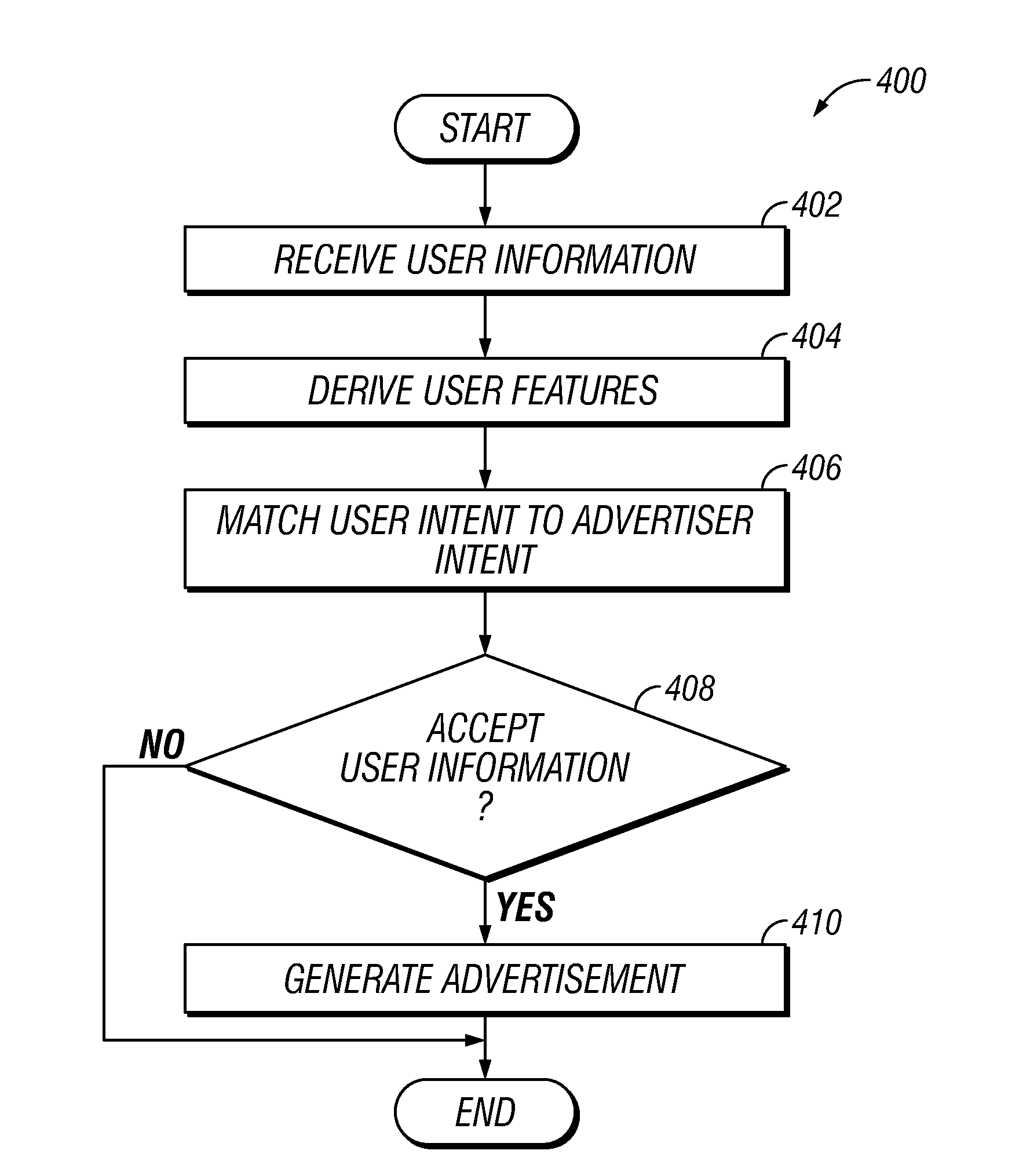

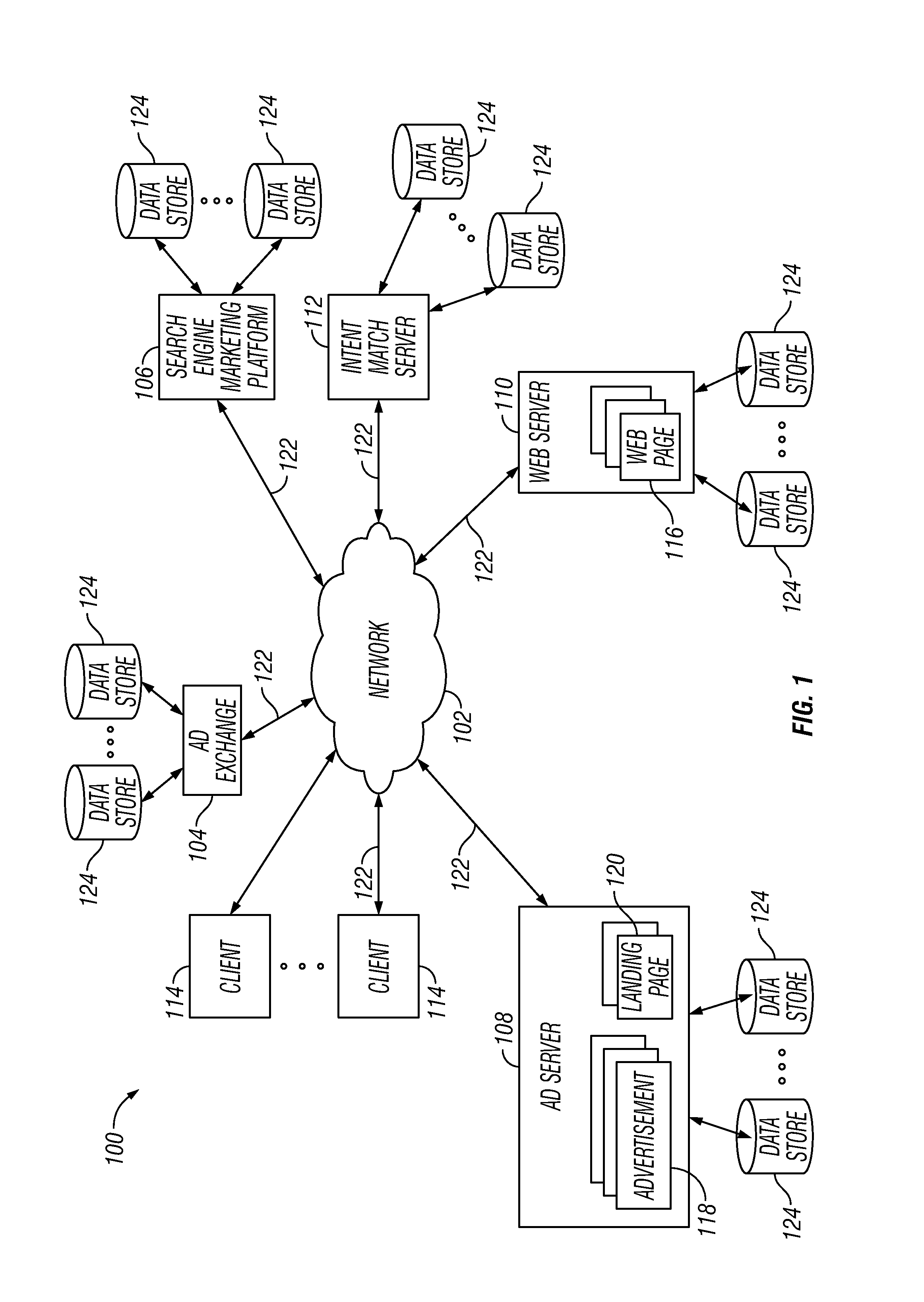

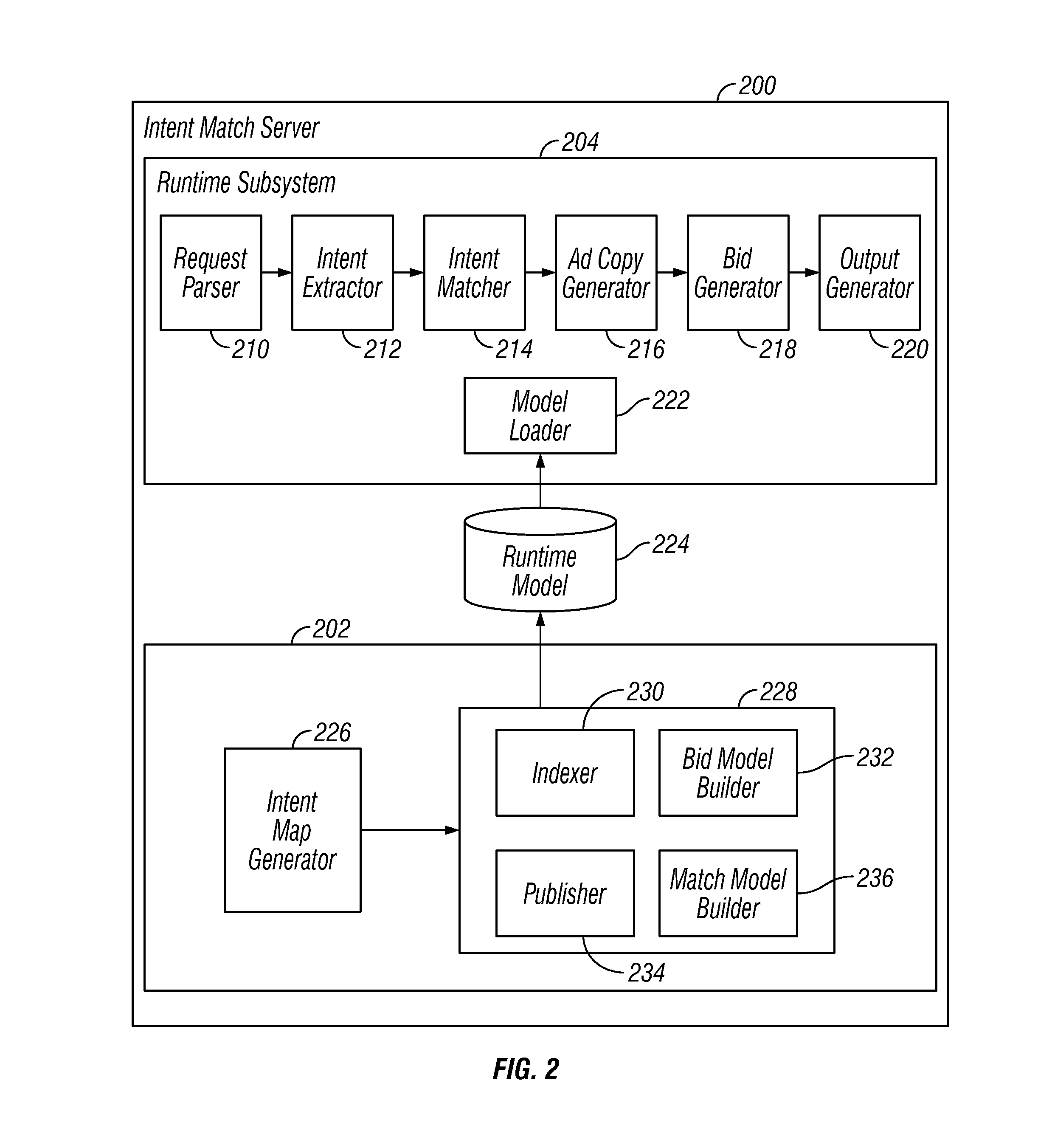

Real-Time Bidding And Advertising Content Generation

ActiveUS20140180815A1Disadvantages can be reduced eliminatedProblems can be reduced eliminatedAdvertisementsContent generationClient

In one embodiment, a method includes receiving, in real-time, user information associated with a user of a client computing device. One or more user features are derived from the user information associated with the user. The one or more user features include one or more user intents. The one or more user intents are matched with one or more of a plurality of advertiser intents. The user information is determined to be accepted. In response to accepting the user information, an advertisement is generated based on the matching of the one or more user intents and the one or more of the plurality of advertiser intents.

Owner:WALMART APOLLO LLC

Pepper plants

InactiveUS7642423B2Avoid rapid degradationLong harvest periodData processing applicationsTissue cultureCapsicum annuumAgronomy

The present invention relates to novel plants, in particular to Capsicum annuum plants capable of producing fruits with extended storability after full coloring of the fruit, and to seeds and fruits of said plants. The present invention also relates to methods of making and using such plants and their fruits. In particular, fruits of plants of the present invention retain marketability over extended periods of time compared to presently available peppers.

Owner:SYNGENTA PARTICIPATIONS AG

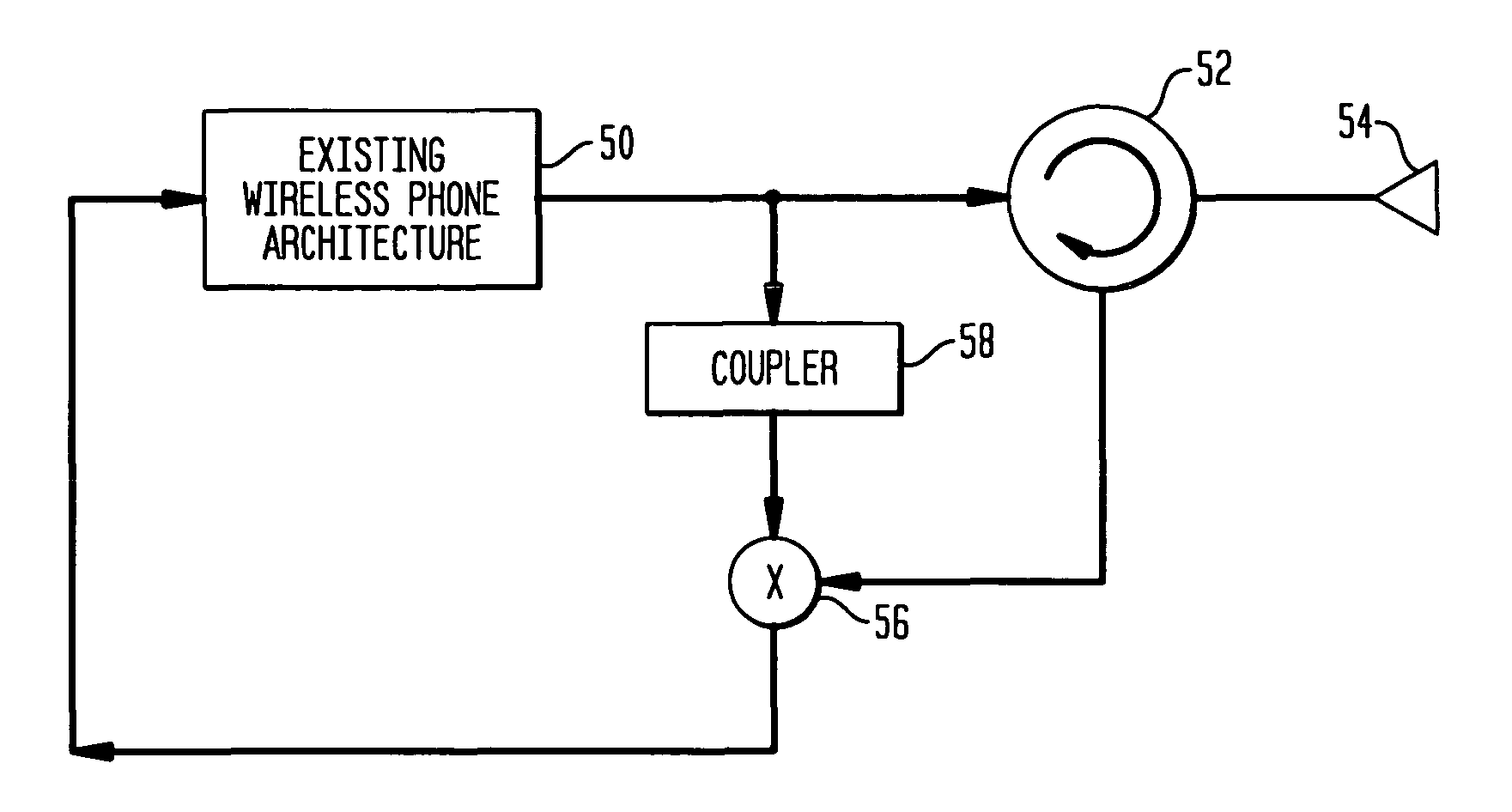

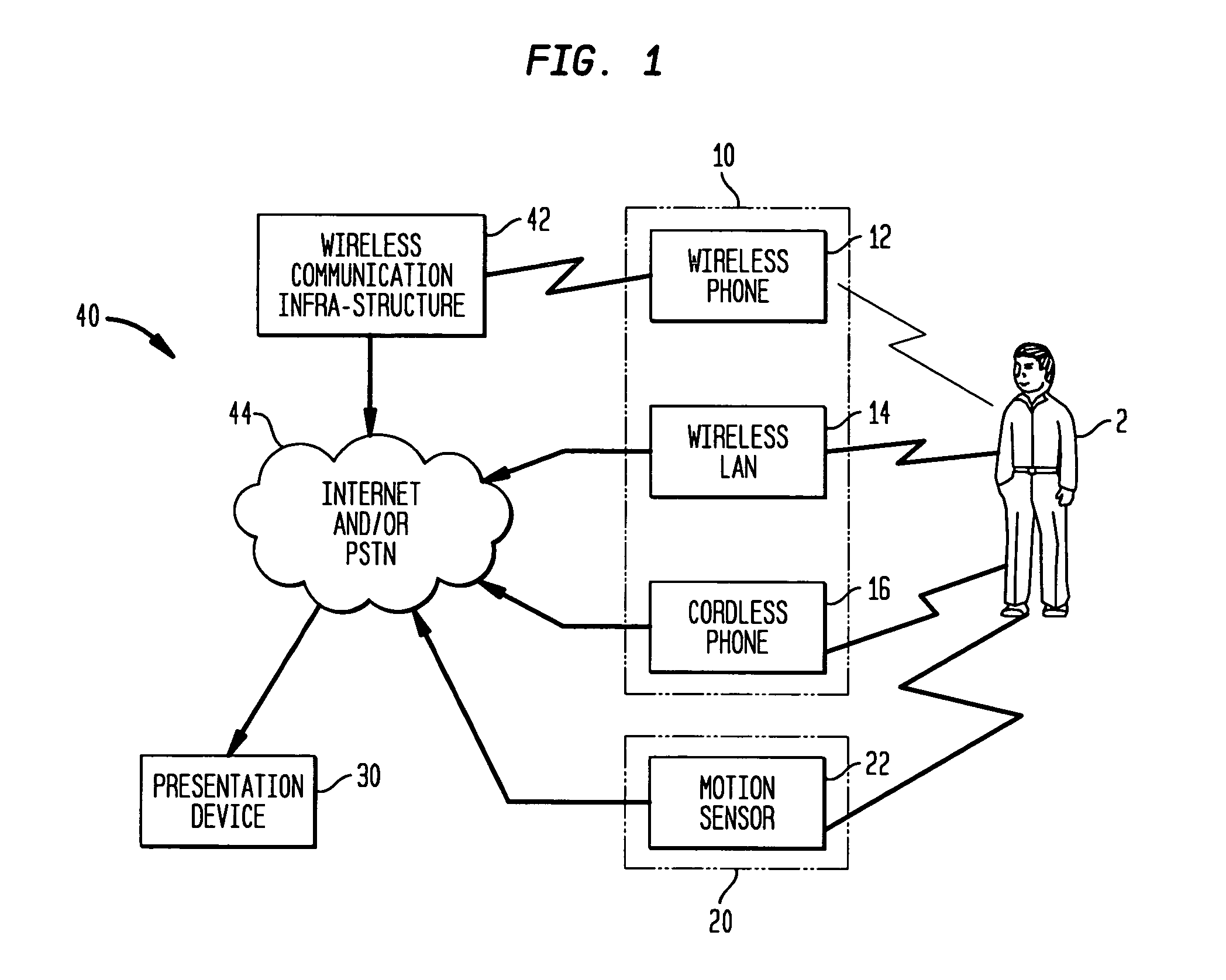

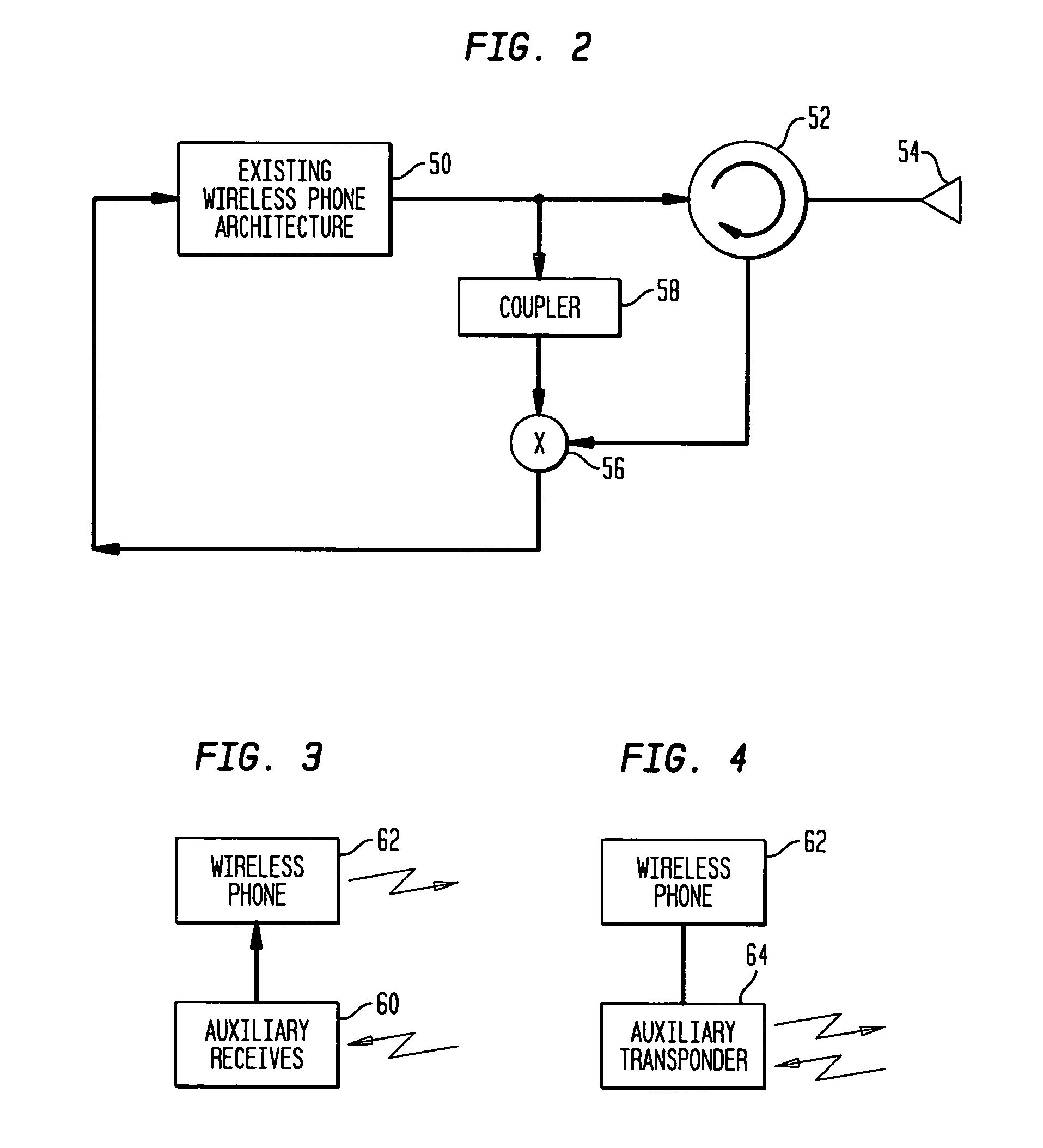

Method and system for non-invasive measurement of prescribed characteristics of a subject

InactiveUS8052600B2Good flexibilityRemove restrictionsSurgeryHeart/pulse rate measurement devicesNon invasiveEngineering

In the non-invasive measuring system, a wireless communication device or other sensing device, gathers Doppler information from signals transmitted by the wireless communication or sensing device and reflected off of a target subject. The gathered information is transferred, preferably, over the existing communication network infra-structure to a presentation device. By placing a body sensor on the target subject, the return of the signal reflected from the subject is enhanced and / or additional information is modulated onto the return signal.

Owner:WSOU INVESTMENTS LLC

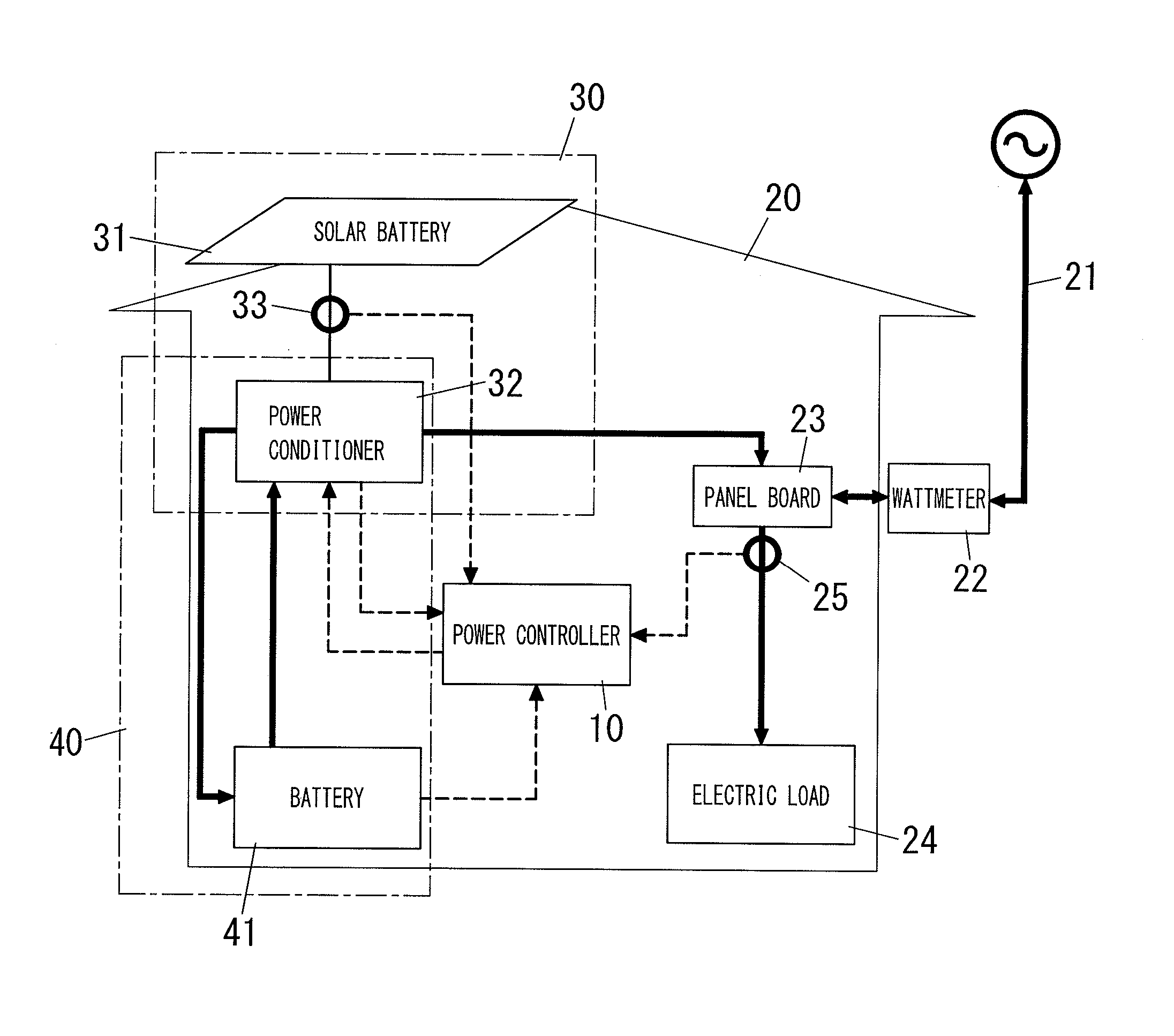

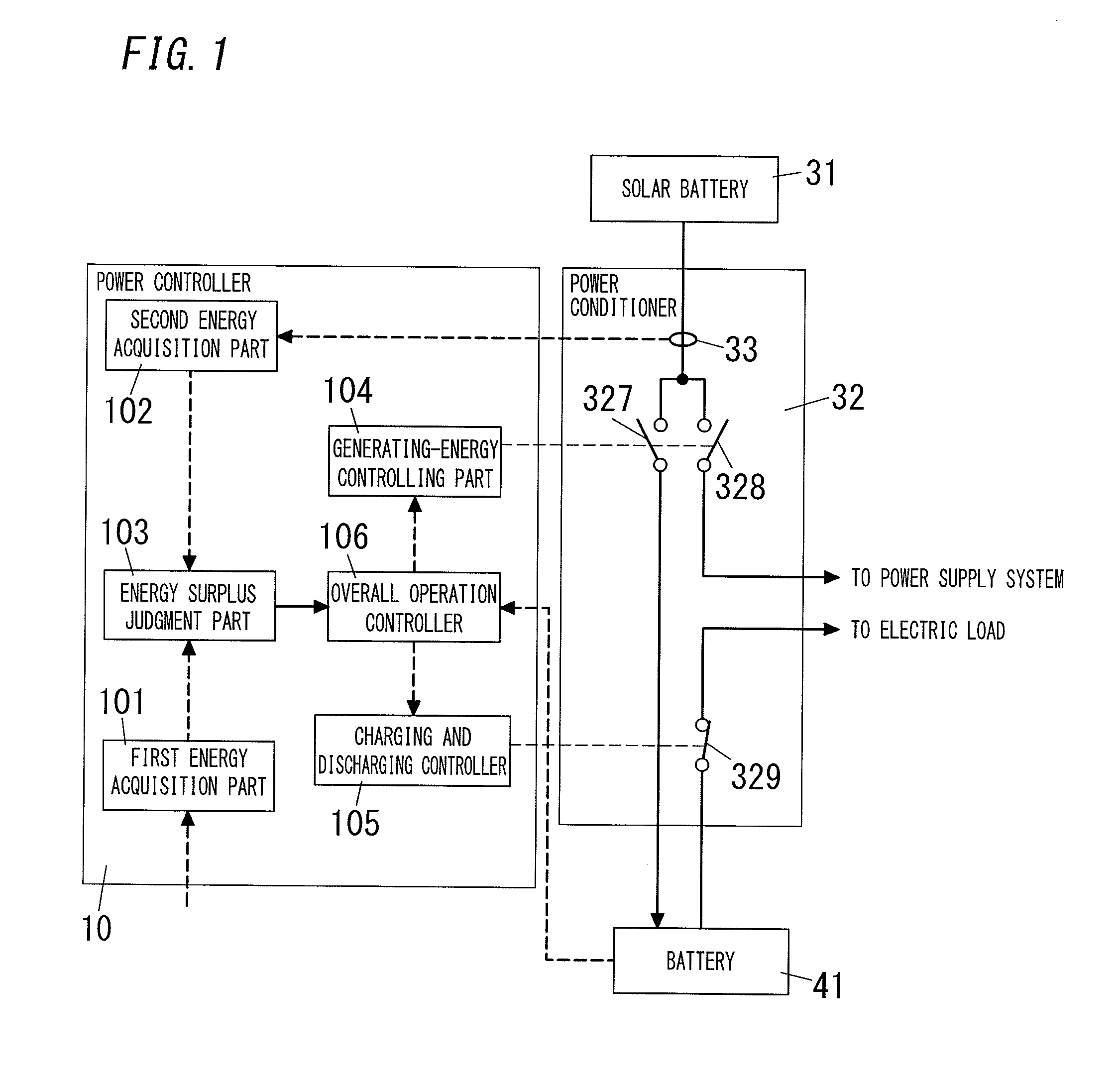

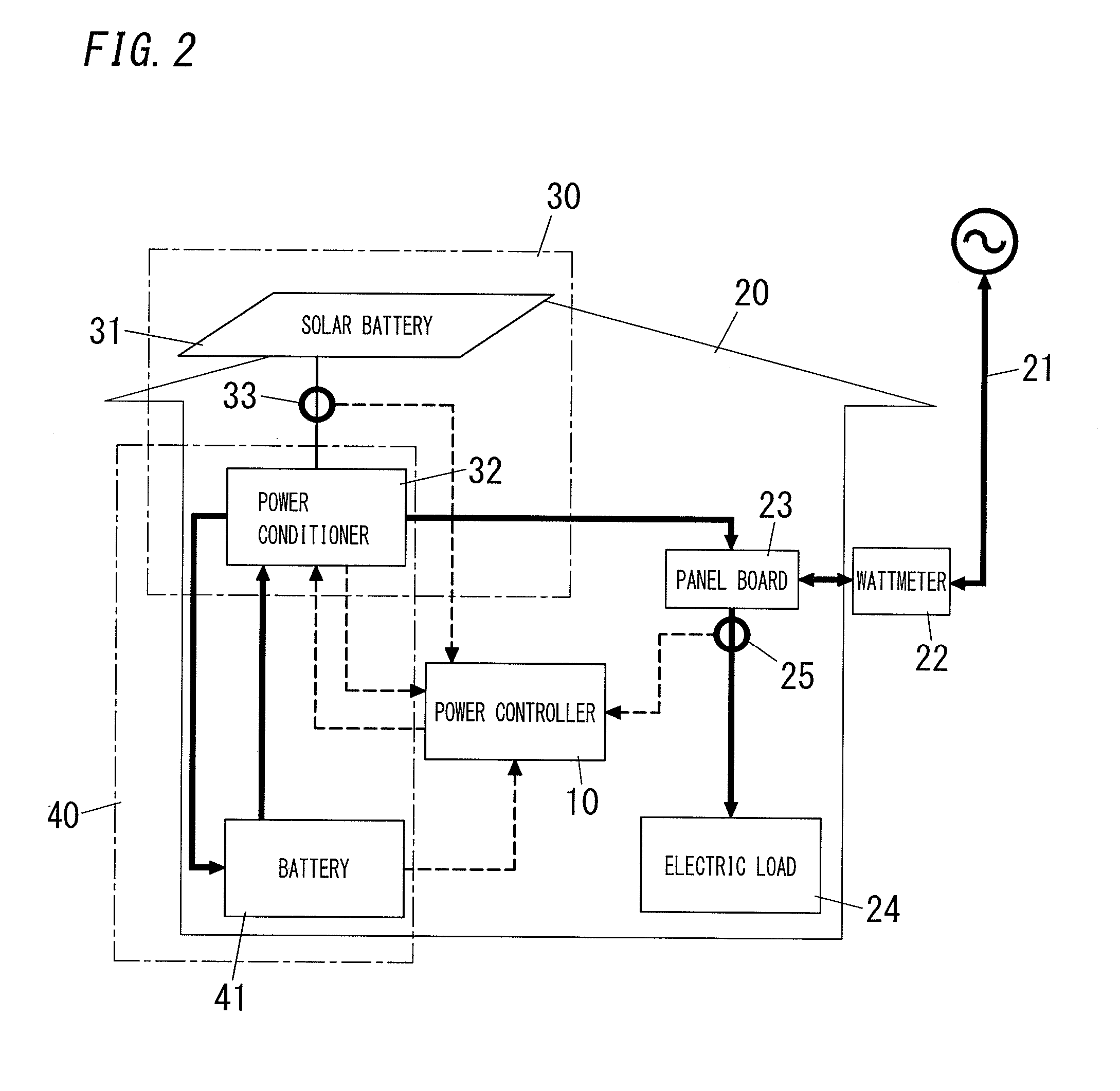

Power controller

InactiveUS20130270911A1Improve electricityWeaken energyBatteries circuit arrangementsElectric powerStored energyElectricity

Residential system includes photovoltaic power system including solar battery, and electrical storage device including battery. Electric load of residential system is selectively supplied with energy from power supply system, power generator and electrical storage device. Power generator allows energy to flow back to power supply system. Energy surplus judgment part calculates difference between generating energy of power generator and demand power for electric load (excess generating energy). Overall operation controller applies stored energy in electrical storage device to demand energy for electric load when excess generating energy is produced, and charges electrical storage device without applying generating energy of power generator to demand energy when excess generating energy is not produced.

Owner:PANASONIC INTELLECTUAL PROPERTY MANAGEMENT CO LTD

Human resource assessment

InactiveUS7668746B2Increase productivityImprove returnHardware monitoringResourcesResource assessmentProgram instruction

Methods, devices, and systems are provided for human resource assessment. A resource planning device includes a processor, a memory, and a user interface coupled to one another. The device includes program instructions storable in the memory and executable by the processor to present, in a selectable configuration, organization specific human resource content after processing according to a selectable set of business rules. The selectable set of business rules are process neutral, brand neutral, and assessment neutral between various organizations. The device can track input to the organization specific content and analyze the input.

Owner:DATA SOLUTIONS

Method for enhancing heavy hydrocarbon recovery

Owner:BAKER HUGHES HLDG LLC

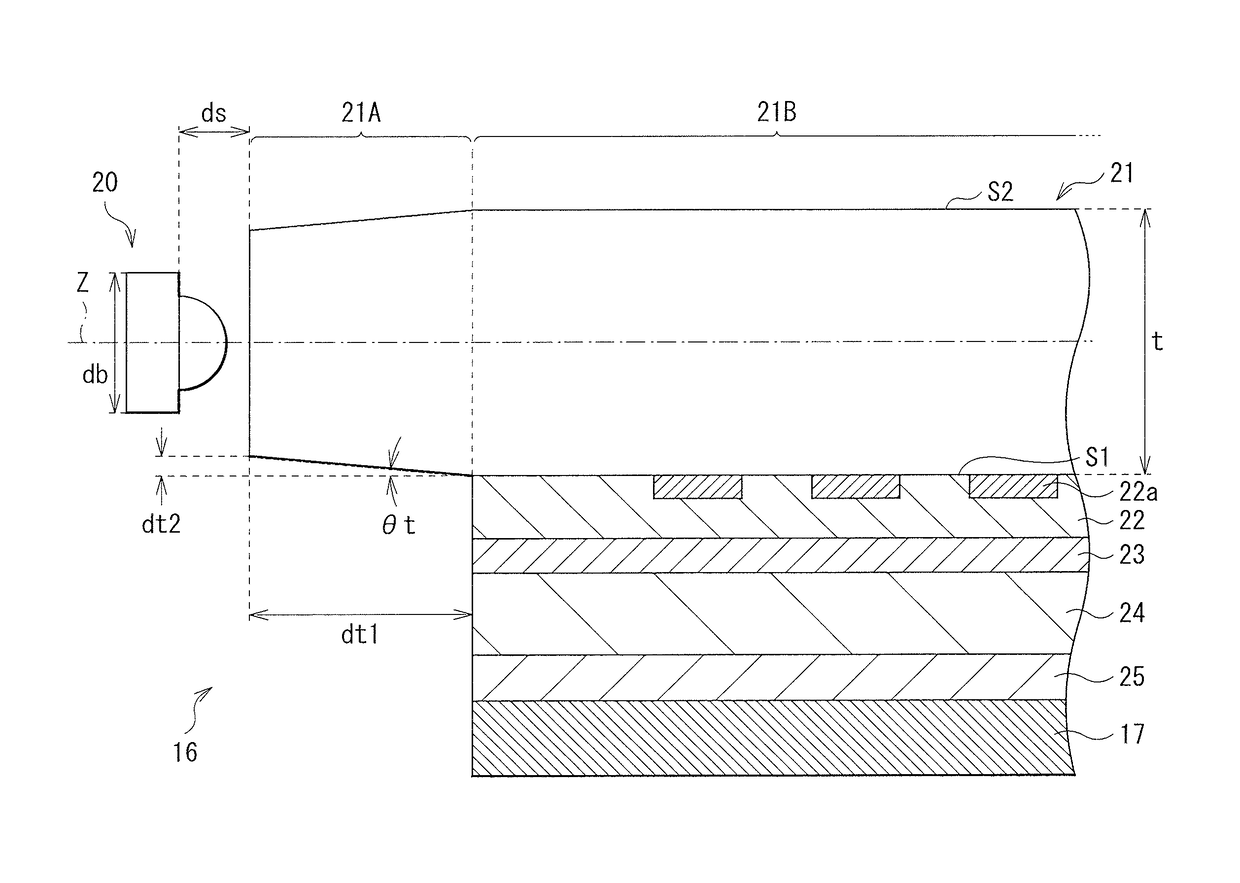

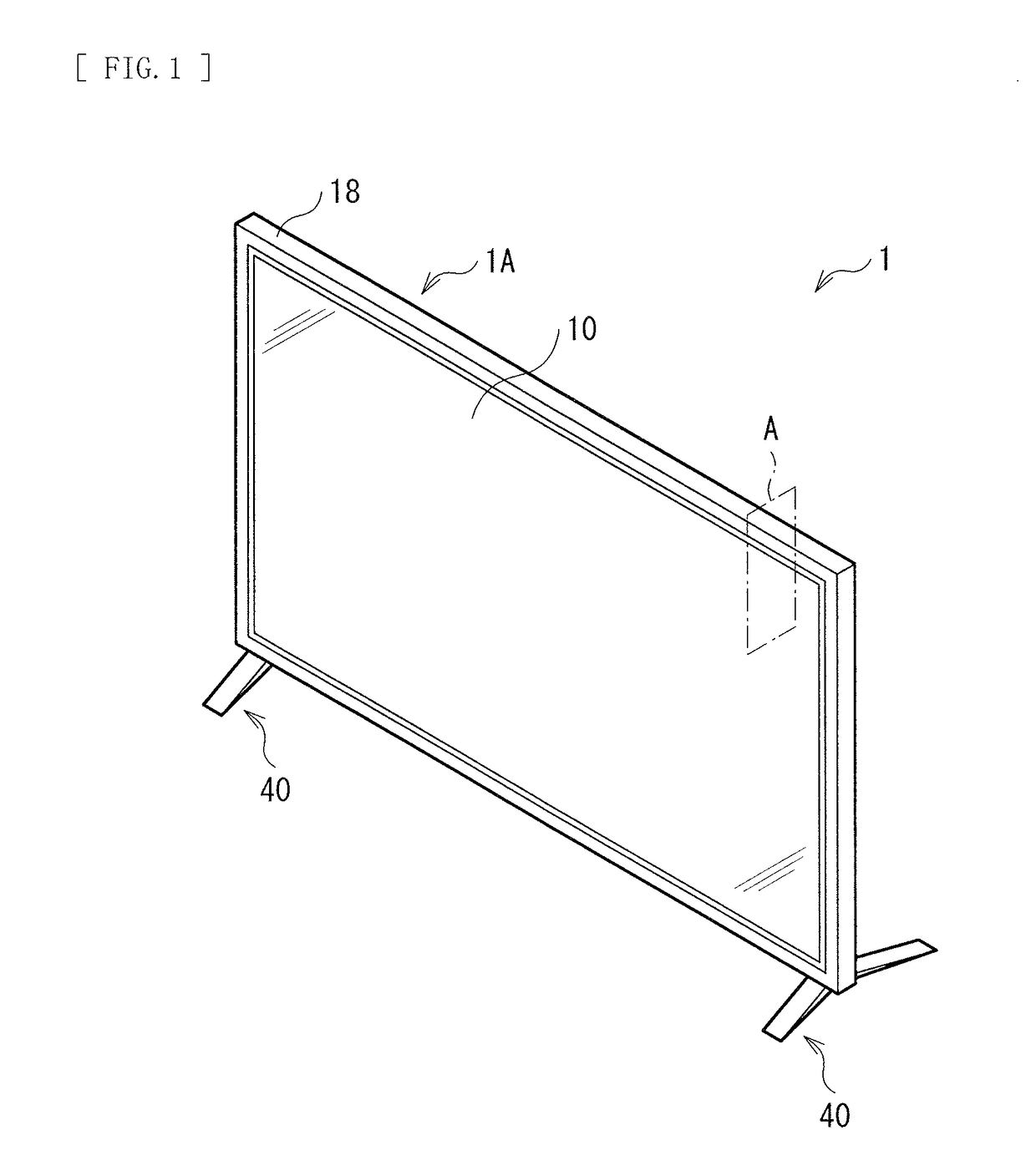

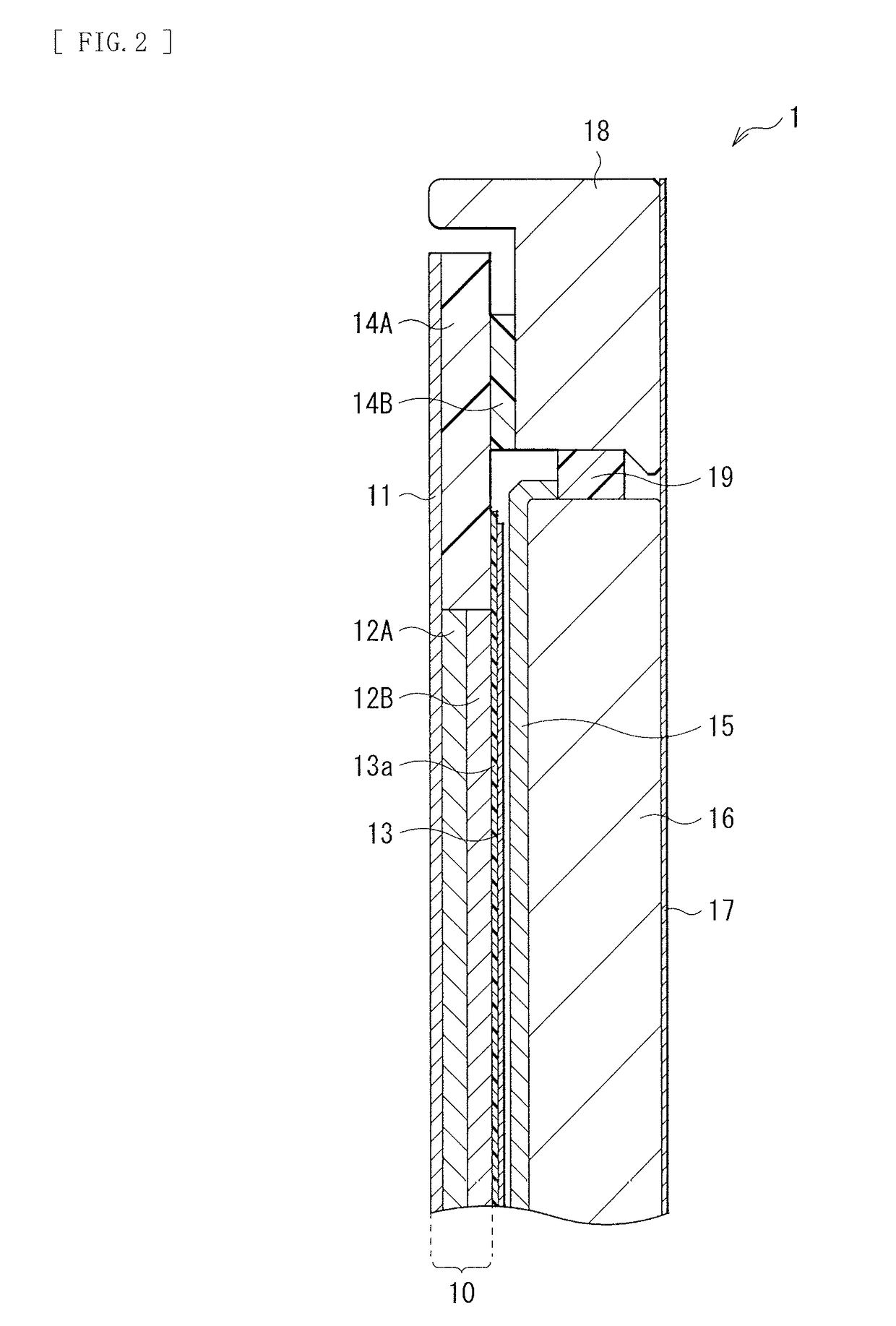

Display device and illumination device

ActiveUS20170227705A1Reduce light lossConvenient lightingMechanical apparatusPlanar/plate-like light guidesLight guideDisplay device

A display device includes a display panel and an illumination section that illuminates the display panel. The illumination section includes: a light guide plate having a first surface and a second surface facing each other; a light source facing an end surface of the light guide plate; an adhesive layer formed adjacent to the first surface of the light guide plate and having substantially the same refractive index as a refractive index of the light guide plate; and a light reflection layer bonded to the first surface of the light guide plate with at least the adhesive layer in between.

Owner:SATURN LICENSING LLC

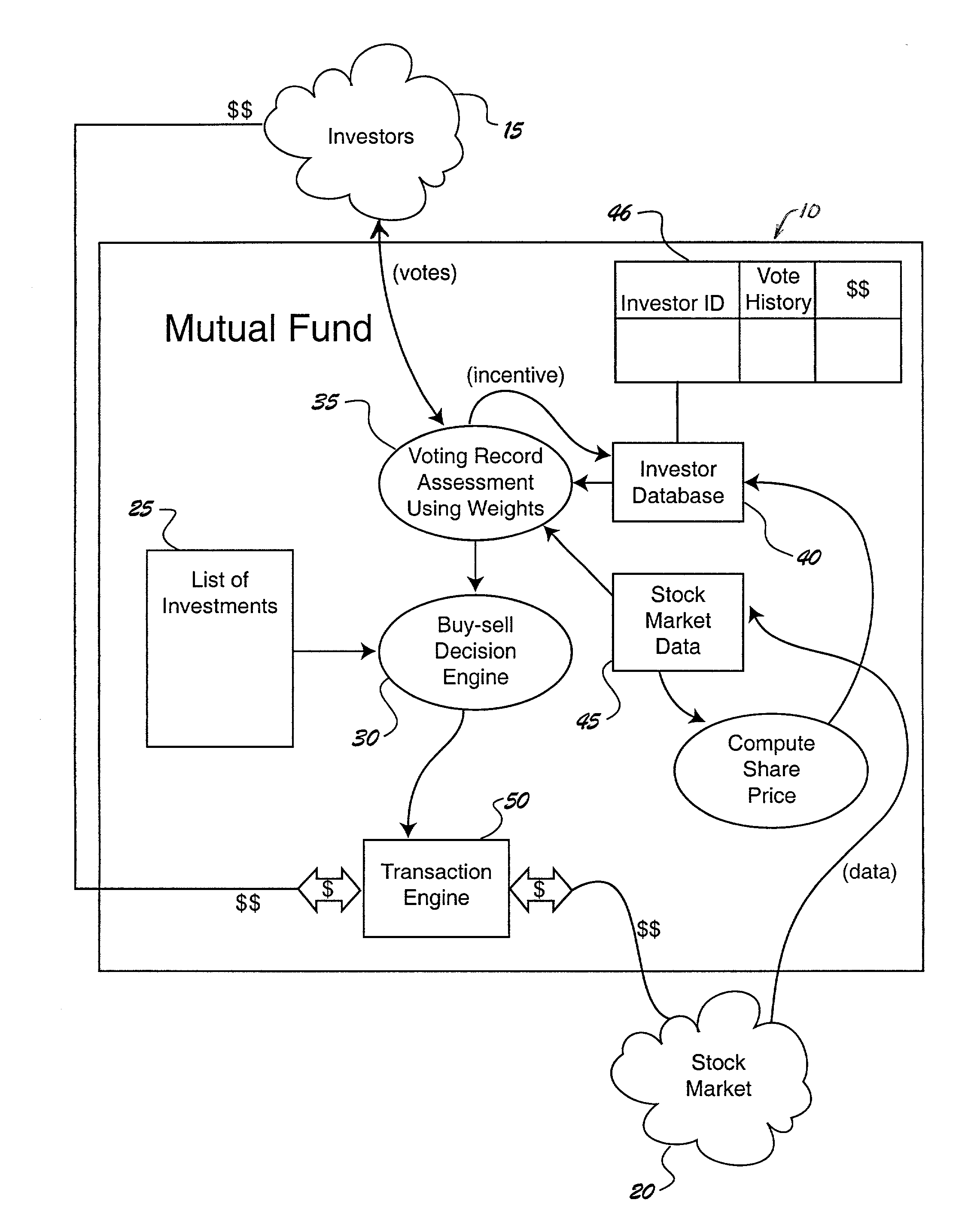

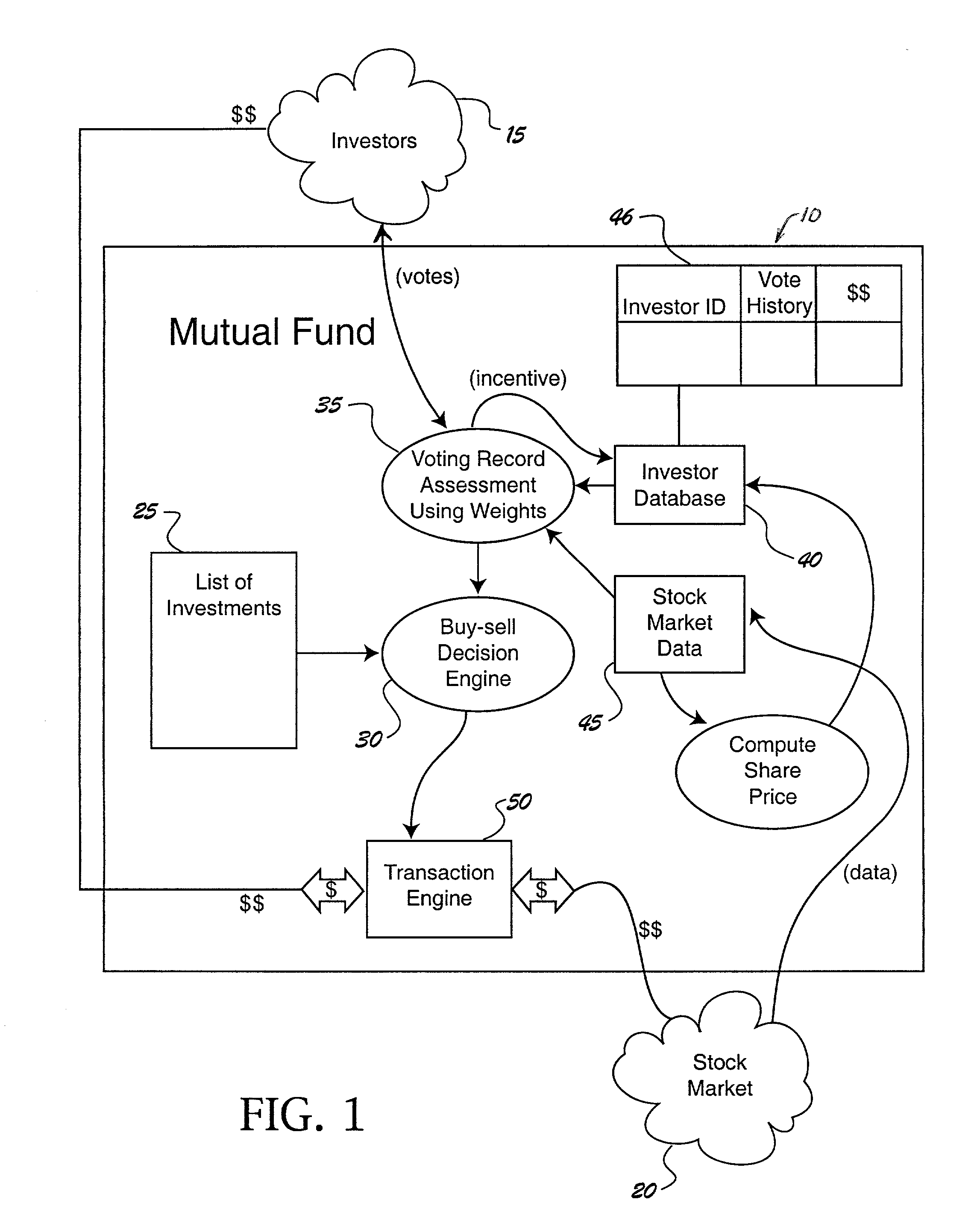

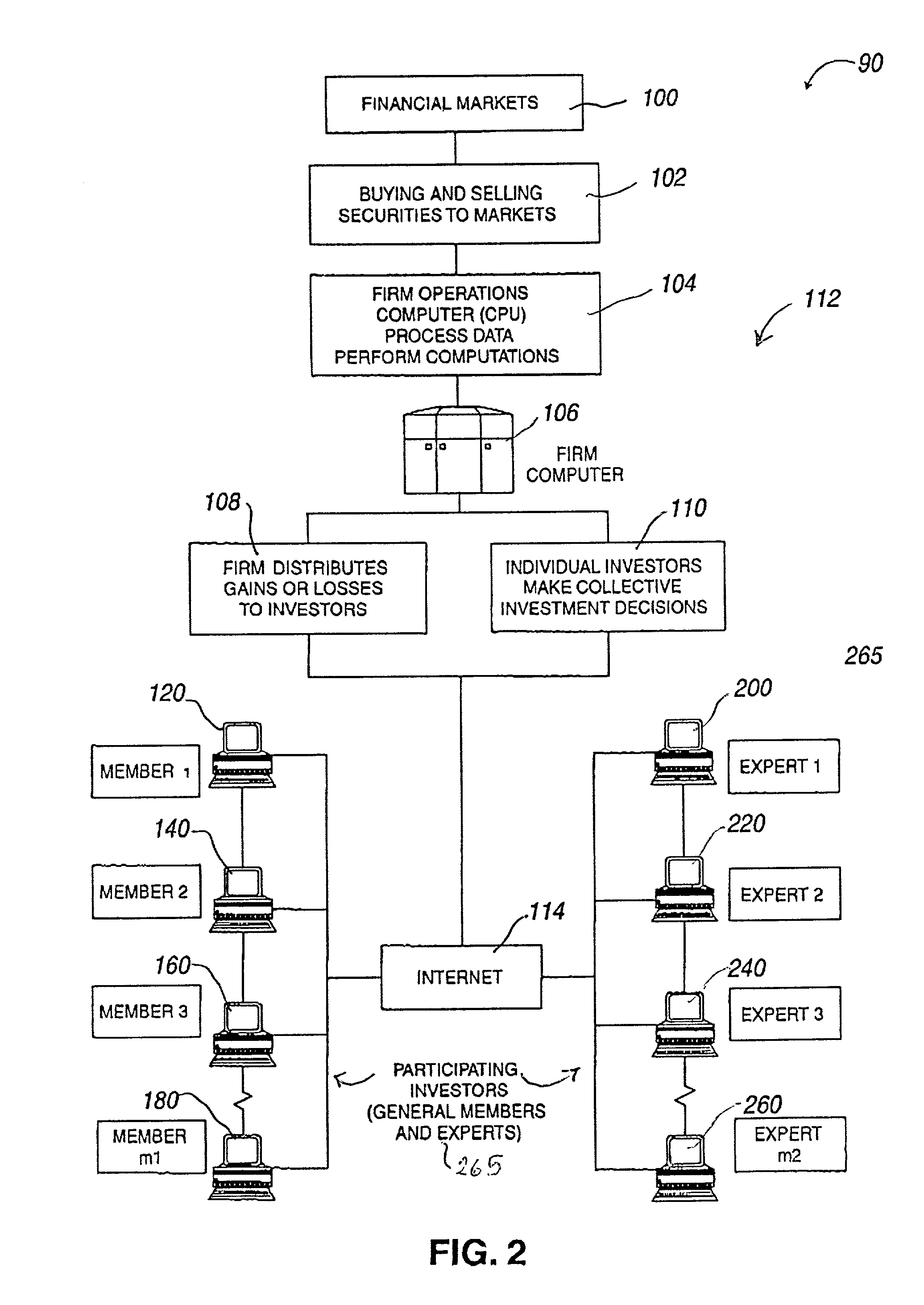

System for winning investment selection using collective input and weighted trading and investing

Members vote on which investments within an agreed upon list of investments they believe should be bought and sold. Members can be general members or experts. Records of each member's voting history are retained and compared against market data showing actual gains and losses associated with each investment. Members whose votes are consistent with actual performance (they made good selections) are given higher weights; members whose votes are inconsistent with actual performance (they made bad selections) are given lower weight. Investment assets are bought and sold based on the collective vote of the members. Members are rewarded for a good voting record by receiving an additional share of the incremental profit of the collective investment.

Owner:PENG KARL +1

Method for Enhancing Heavy Hydrocarbon Recovery

Amines or ammonia and amines may be used to enhance recovery of heavy hydrocarbons. The amines or ammonia and amines alone or with water, steam or an oil solvent are combined with the heavy hydrocarbons to promote the transport of the heavy hydrocarbons. The amines or ammonia and amines may be injected downhole or admixed with heavy hydrocarbon containing ore on the surface, optionally with water or steam. Ammonia may be used alone with high quality steam.It is emphasized that this abstract is provided to comply with the rules requiring an abstract which will allow a searcher or other reader to quickly ascertain the subject matter of the technical disclosure. It is submitted with the understanding that it will not be used to interpret or limit the scope or meaning of the claims.

Owner:BAKER HUGHES INC

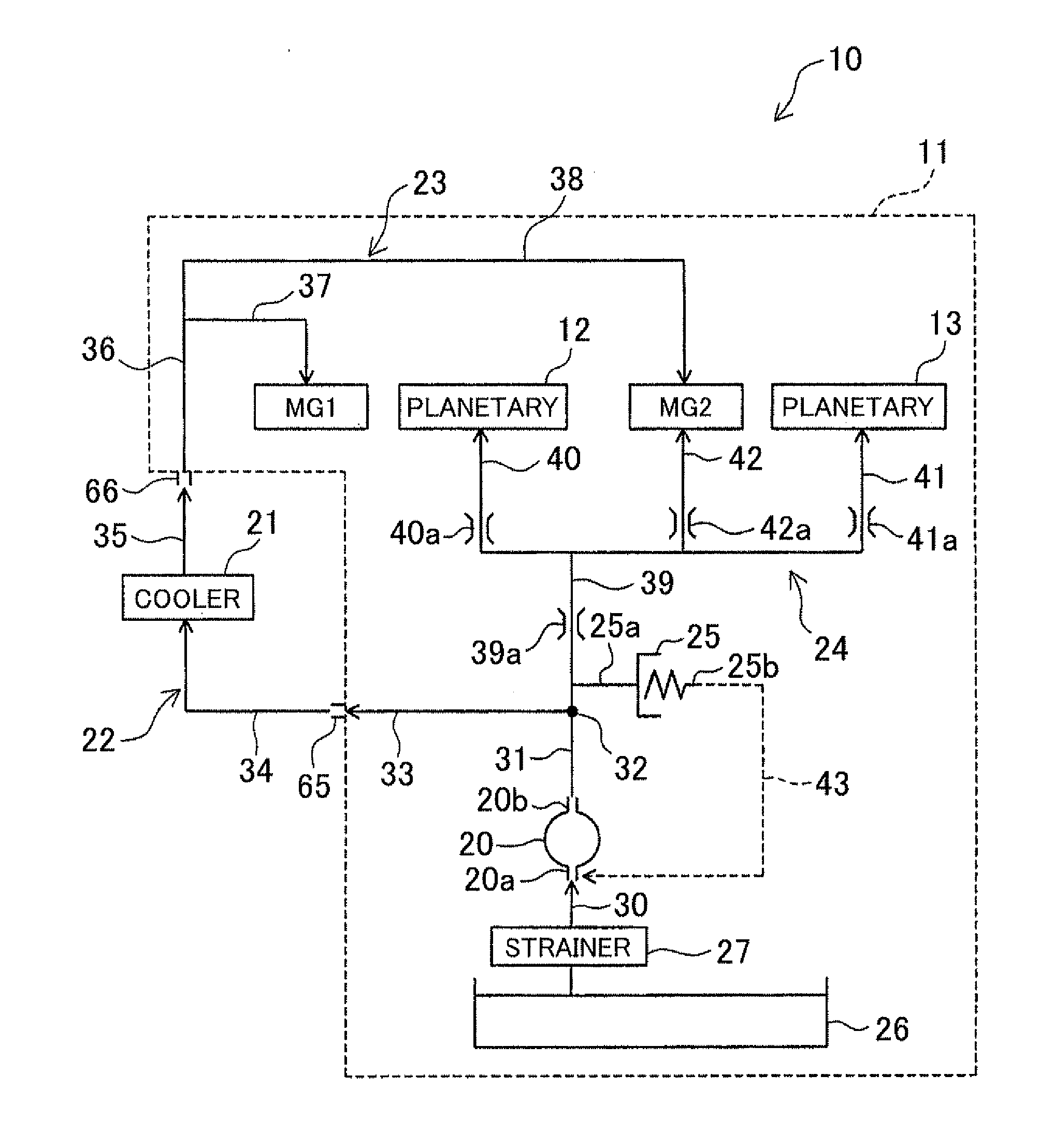

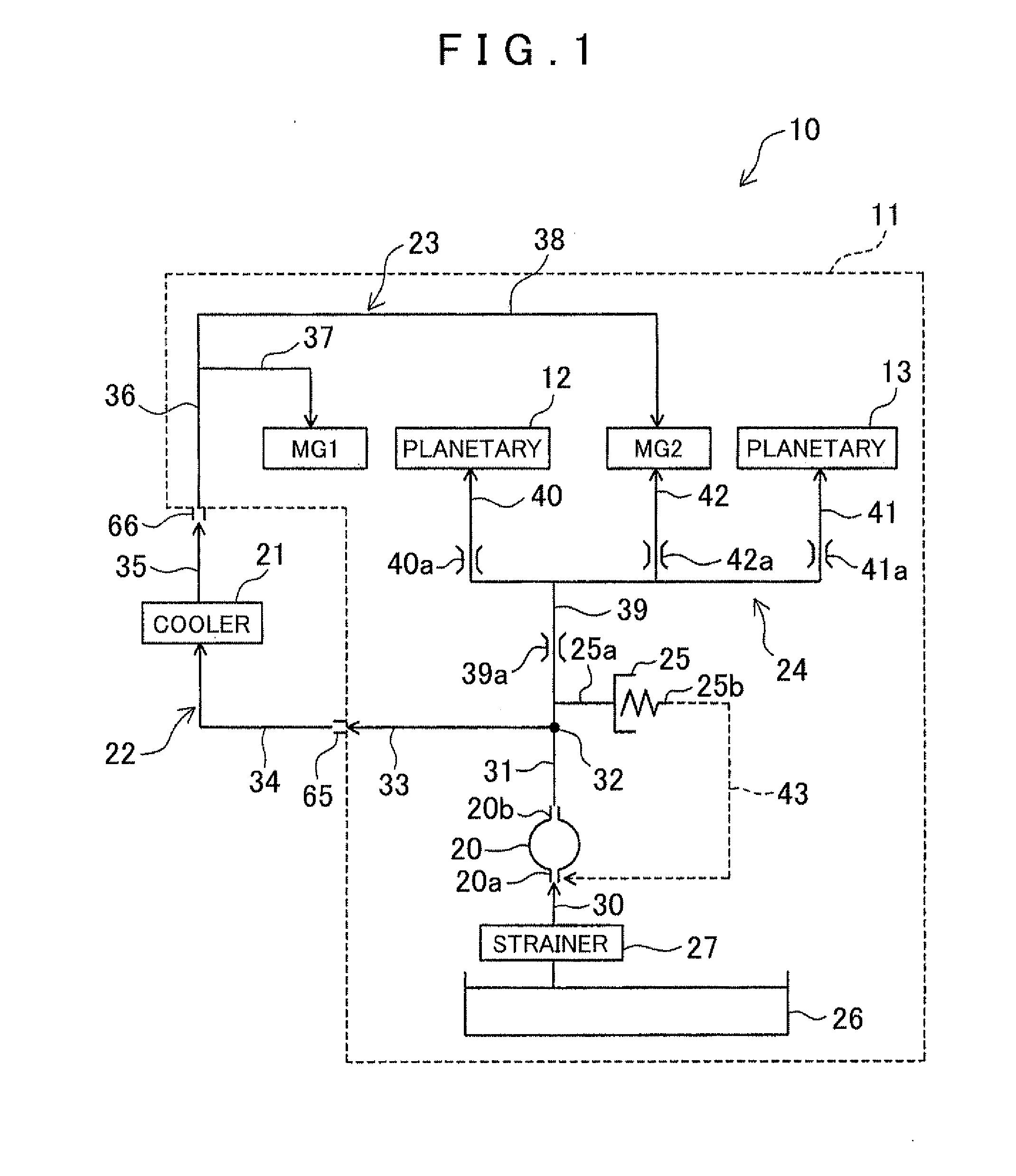

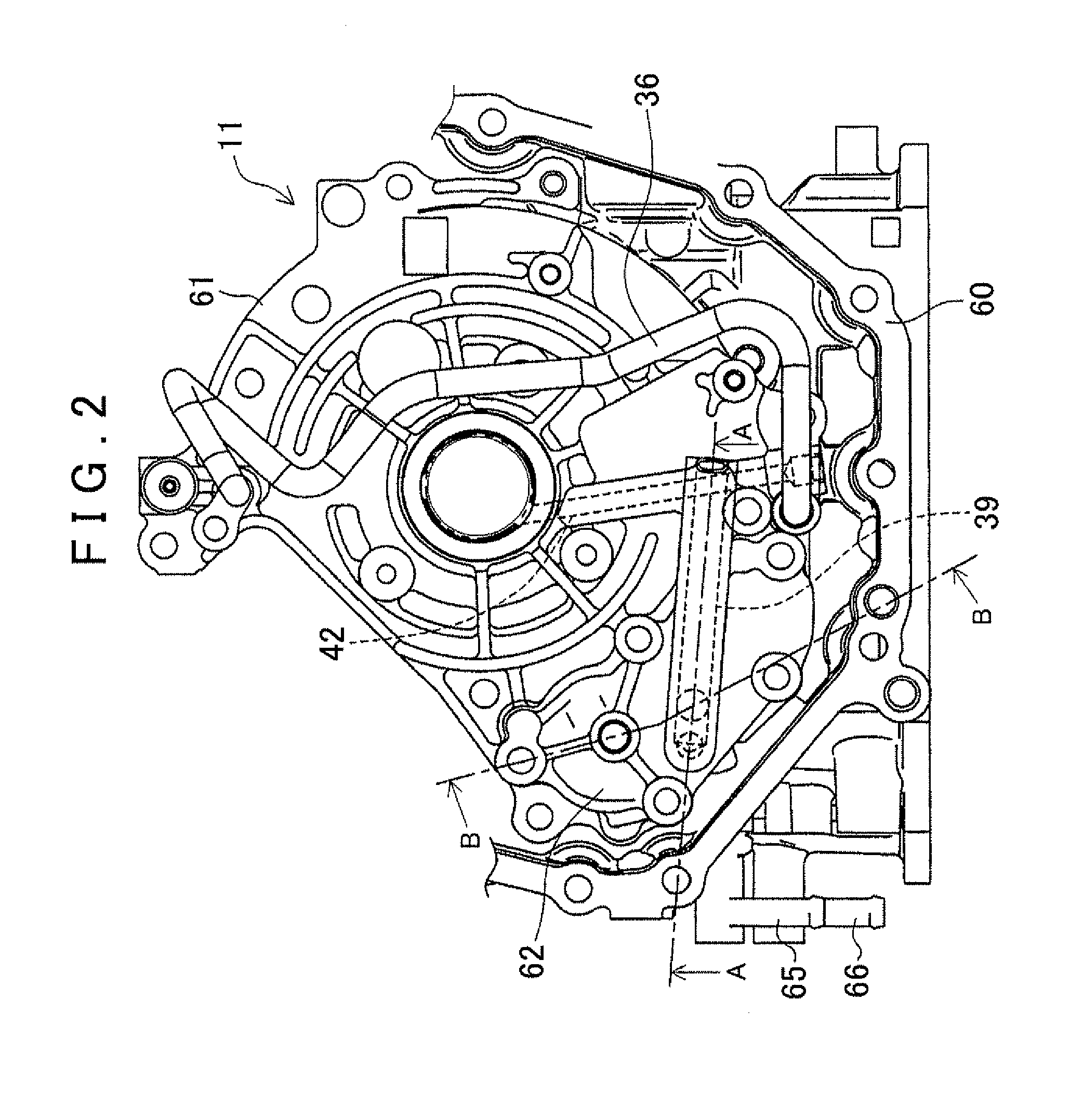

Vehicle drive system

ActiveUS20110232786A1Efficiently returnedImprove efficiencyHybrid vehiclesGear lubrication/coolingMotor–generatorElectric motor

A vehicle drive system, including a motor generator; a gear group having a plurality of gears; and a motor cooling circuit for cooling the motor generator. The system further includes a lubricating circuit for lubricating the gear group; a cooler circuit in which an oil cooler is provided; and an oil pump that supplies oil to each circuit. The motor cooling circuit is arranged in series with and downstream of the cooler circuit, and the lubricating circuit is arranged parallel to the cooler circuit with respect to the oil pump.

Owner:AISIN AW CO LTD +1

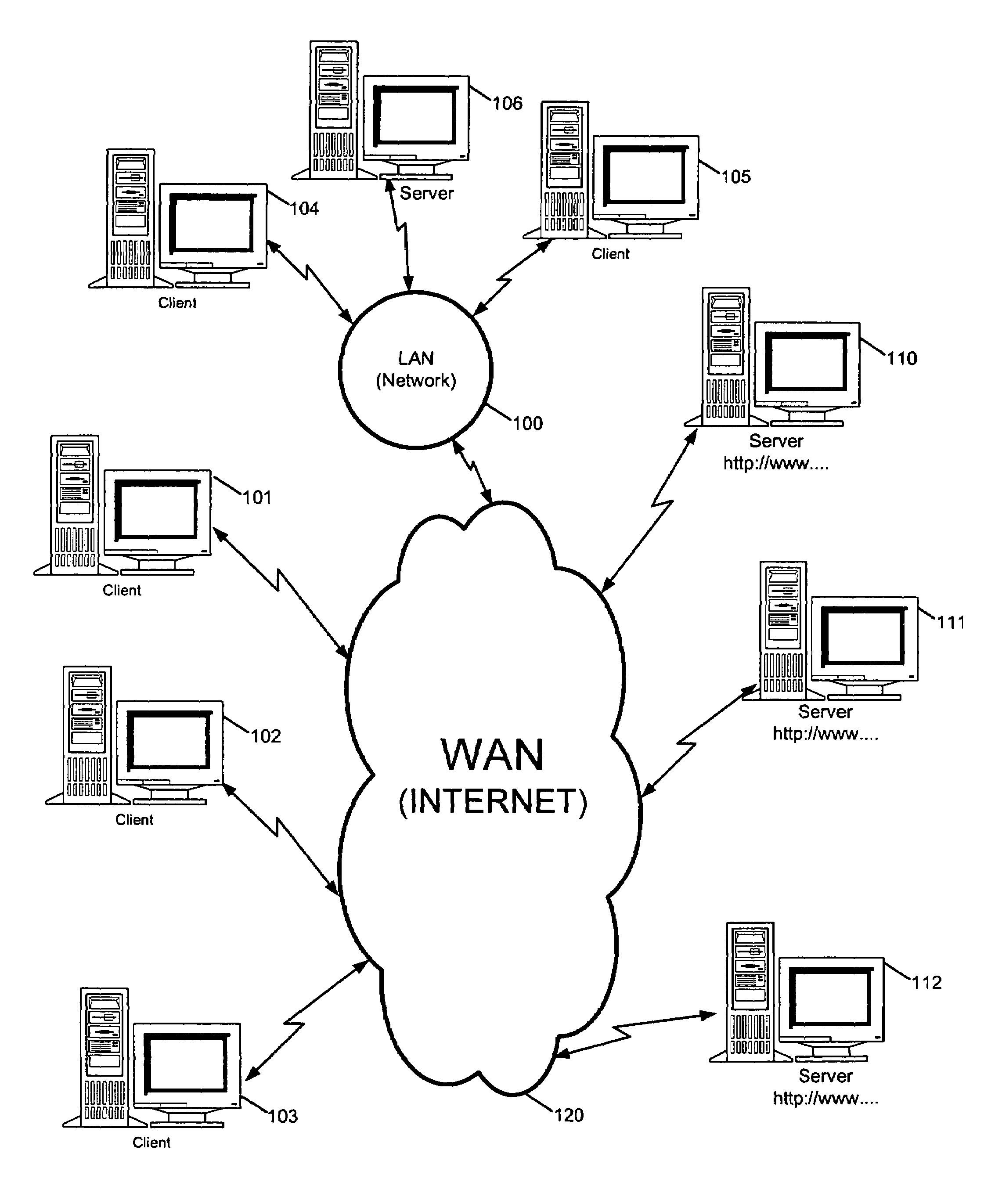

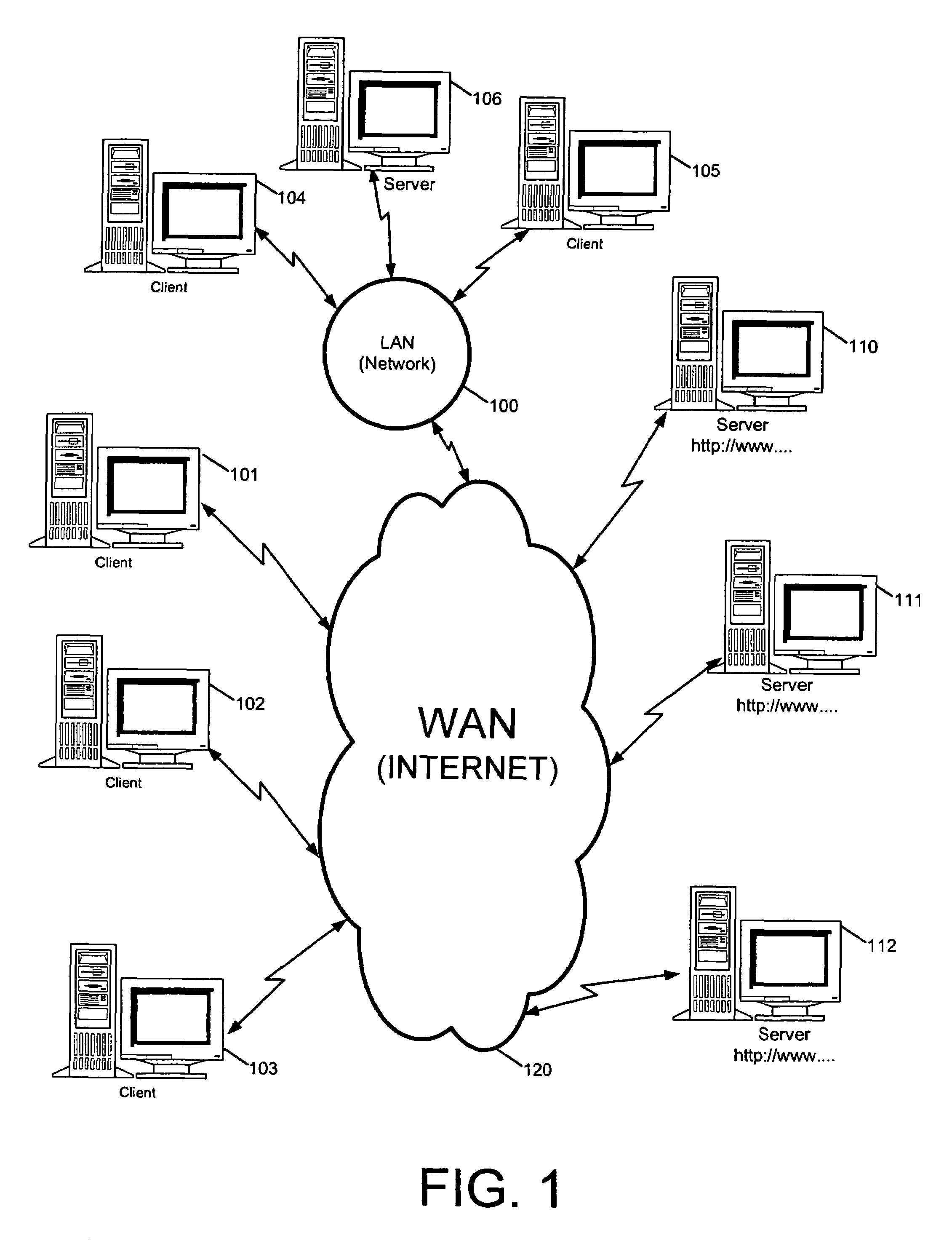

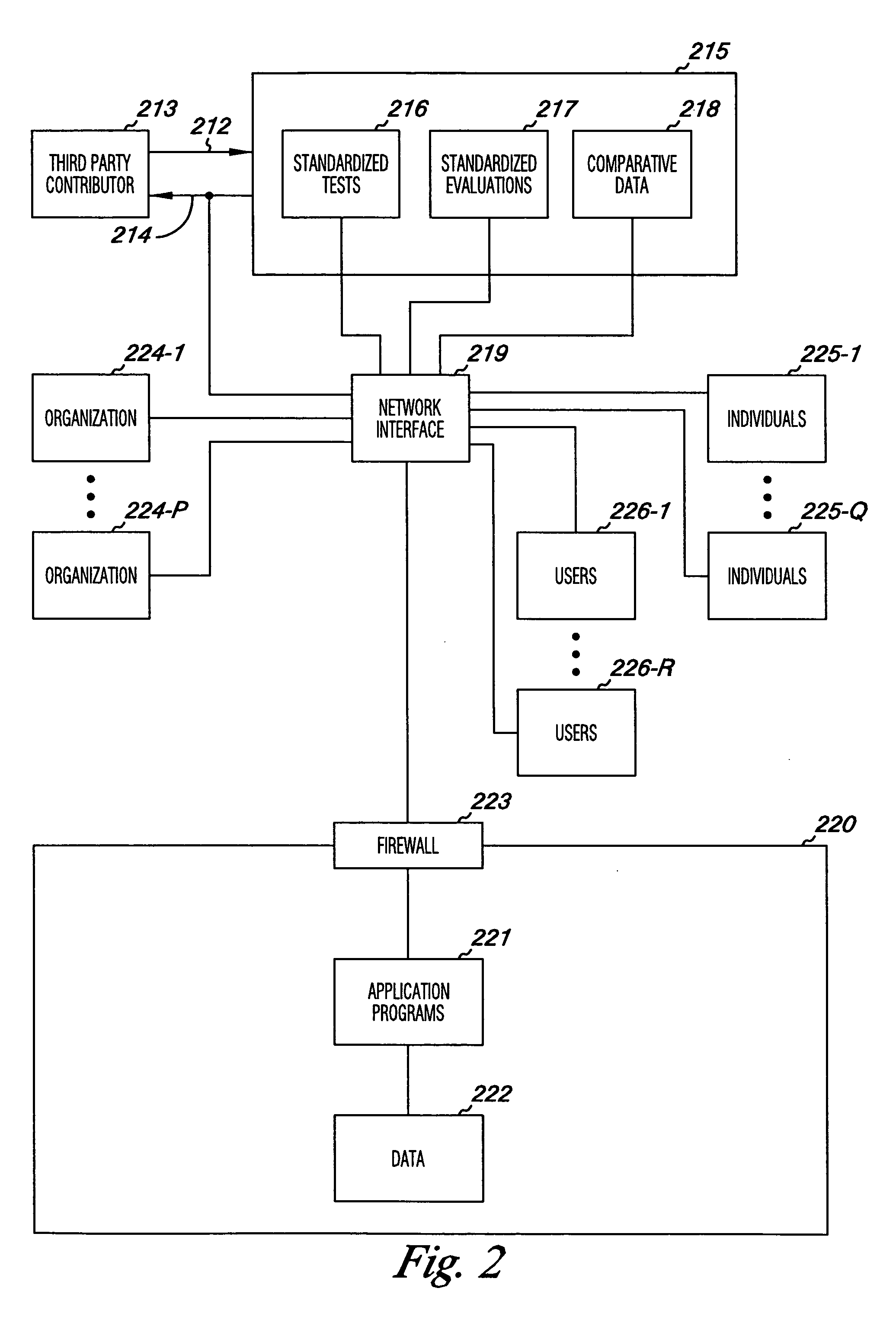

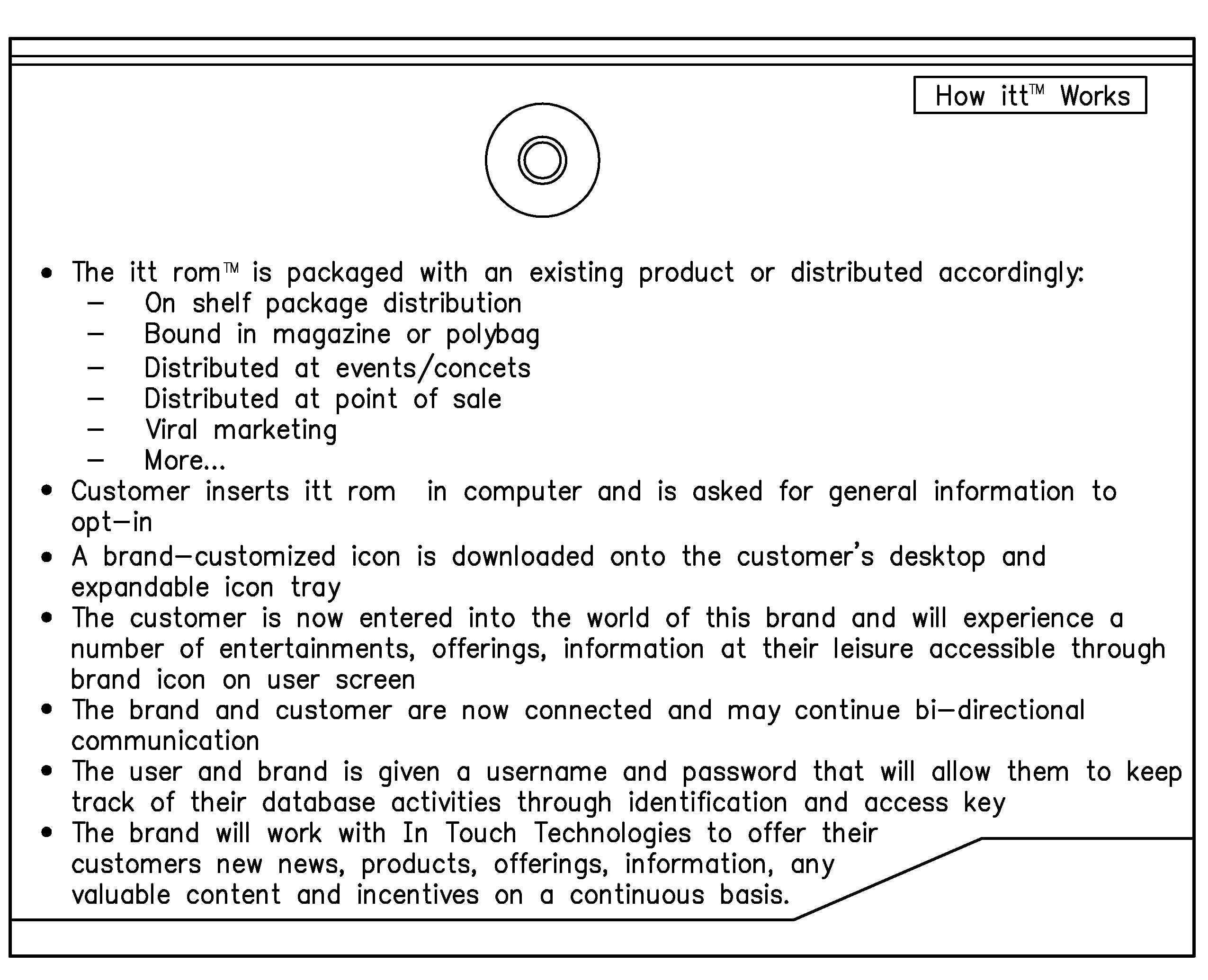

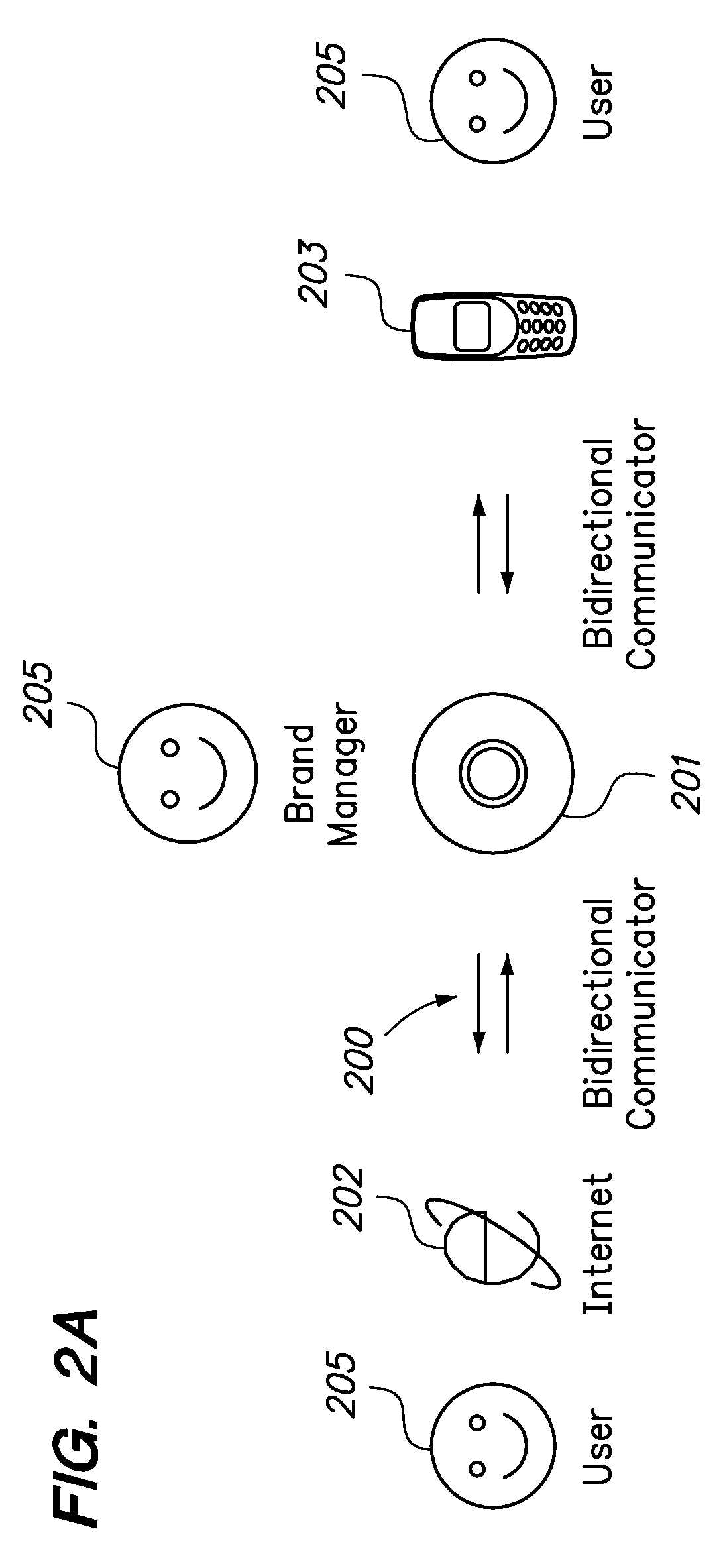

System and Method For Enabling Bi-Directional Communication Between Providers And Consumers of Information In Multi-Level Markets Using A Computer Network

A system and method for enabling continuous bidirectional communication between providers and consumers of information through a computer and telephone network to exchange product and preference information. The system and method of the invention provides a database having accounts for providers and consumers. Each account contains contact, warranty, product, system usage, and billing information for providers, and contact, demographic, product preference, contact permissions, and usage history information for consumers. The invention provides an area for consolidation of all provider access points in a taskbar on the user's computer or communication device. The invention creates an ad reviewing cart that allows users to select providers and content to be received. An information warehouse manager is employed to receive data from providers and users. A commission accounting module calculates commissions.

Owner:QUBEEY INC +1

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com