Patents

Literature

92results about How to "Avoid rigidity" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

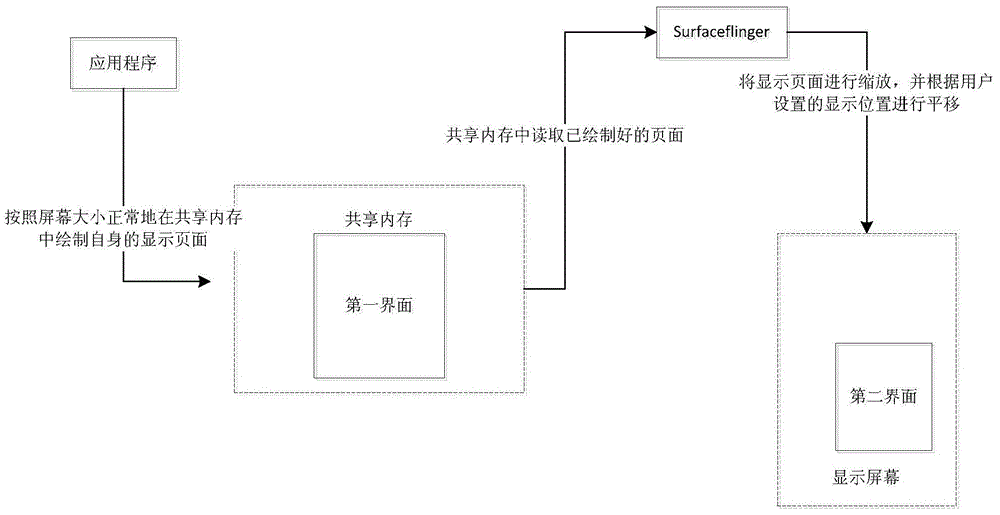

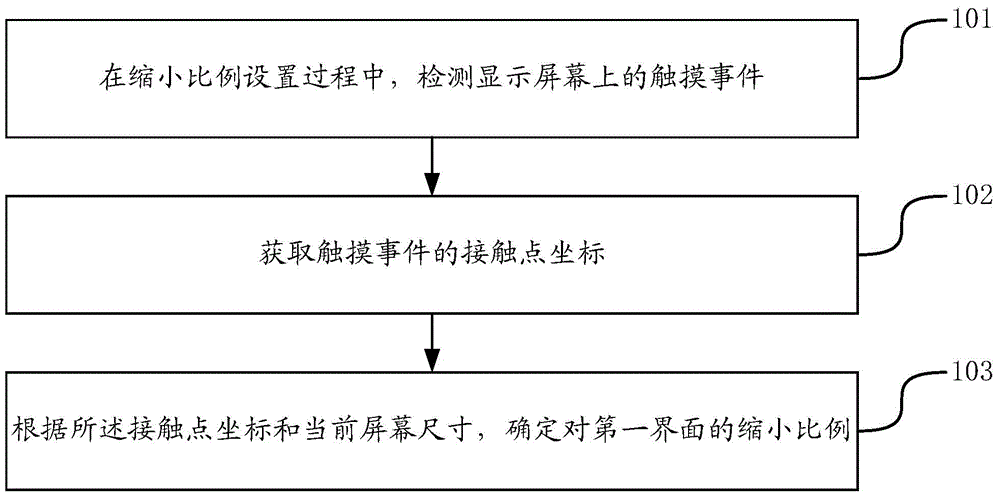

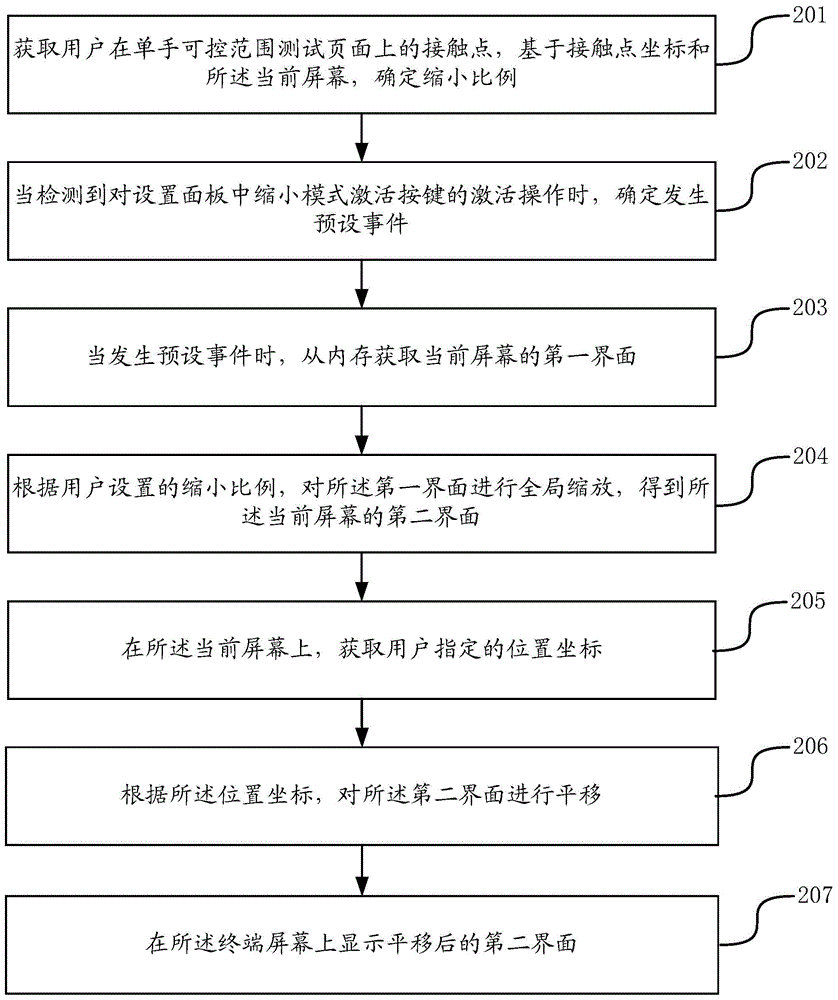

Method and device for determining reduction scale in screen display process

InactiveCN104461232AAvoid rigiditySimplifies the scaling processInput/output processes for data processingEvent triggerHuman–computer interaction

The invention discloses a method and device for determining a reduction scale in the screen display process, and belongs to the technical field of terminals. The method includes the steps that a touch event on a display screen is detected in the reduction scale setting process; contact point coordinates of the touch event are obtained; according to the contact point coordinates and the current screen size, the reduction scale of a first interface is determined. By means of the method and device, in the reduction scale setting process, according to the contact point coordinates of the touch event triggered by a user on the display screen, the reduction scale of the interface is rapidly determined, ossification of interface display is avoided, the scale setting process is simplified, a more effective man-computer interactive process is provided, and the user can directly determine the needed size of a screen in a wysiwyg mode.

Owner:XIAOMI INC

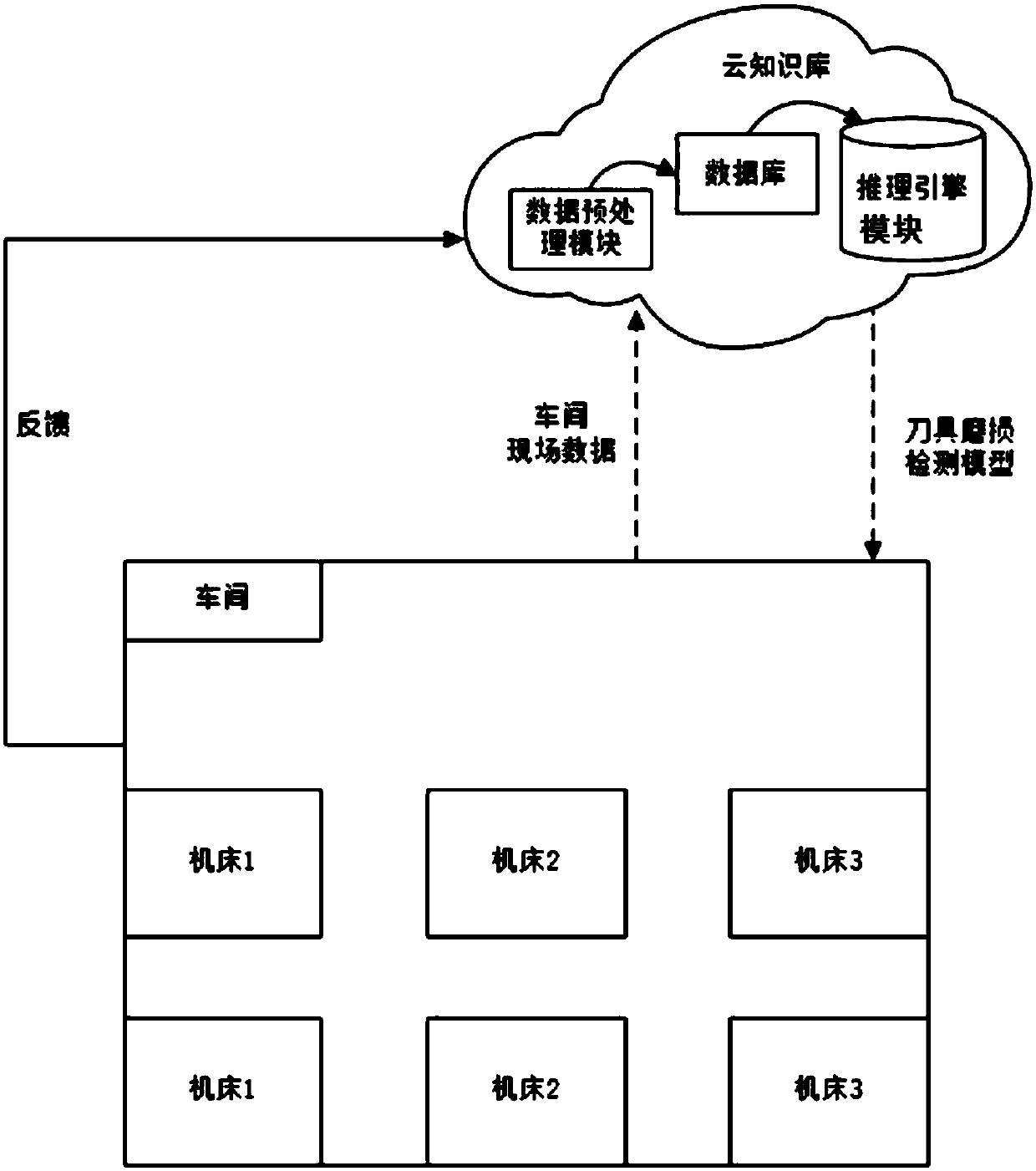

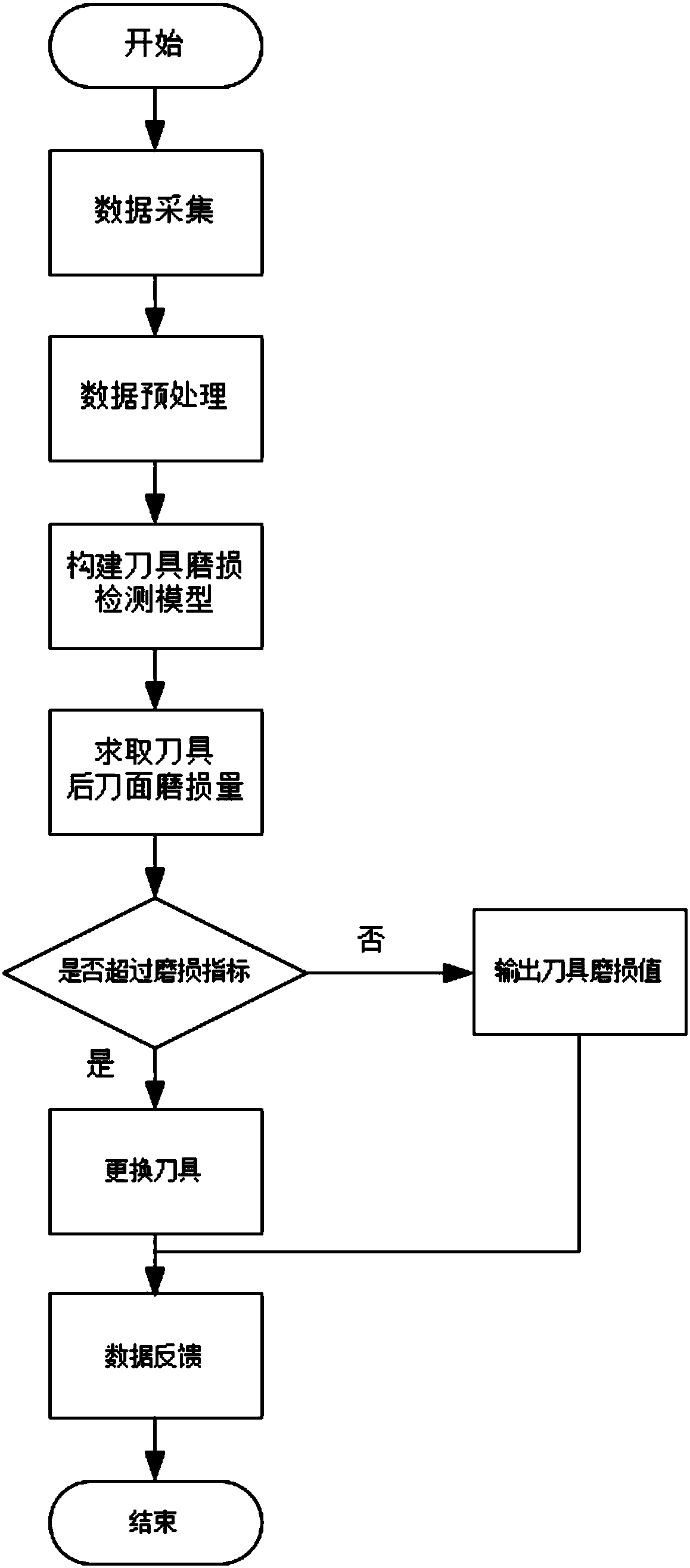

Numerical control device cutter wearing detection method based on cloud knowledge base and machine learning

InactiveCN108107838AImplement storageAchieving processing powerProgramme controlComputer controlNumerical controlComputer science

The present invention relates to a numerical control device cutter wearing detection method based on a cloud knowledge base and machine learning. The method comprises the steps of: A, constructing andtraining a cutter wearing detection model: (1) establishing a cloud knowledge base, (2) collecting condition data of a workshop and storing the condition data, (3) designing a cutter wearing detection model, and employing a support vector machine to perform training of the cutter wearing detection model; and B, performing cutter wearing detection through the cutter wearing detection model: (4) updating the cutter wearing detection model to a local numerical control machine tool, performing detection of a cutter on the local numerical control machine tool, and when the cutter wearing amount achieve a dulling standard, replacing the cutter, and (5) taking newly detected condition data and the detected cutter wearing amount as feedback information, and transmitting the feedback information to the local numerical control machine tool through a network. The cutter wearing cutter prediction accuracy rate and the detection speed are improved.

Owner:SHANDONG UNIV

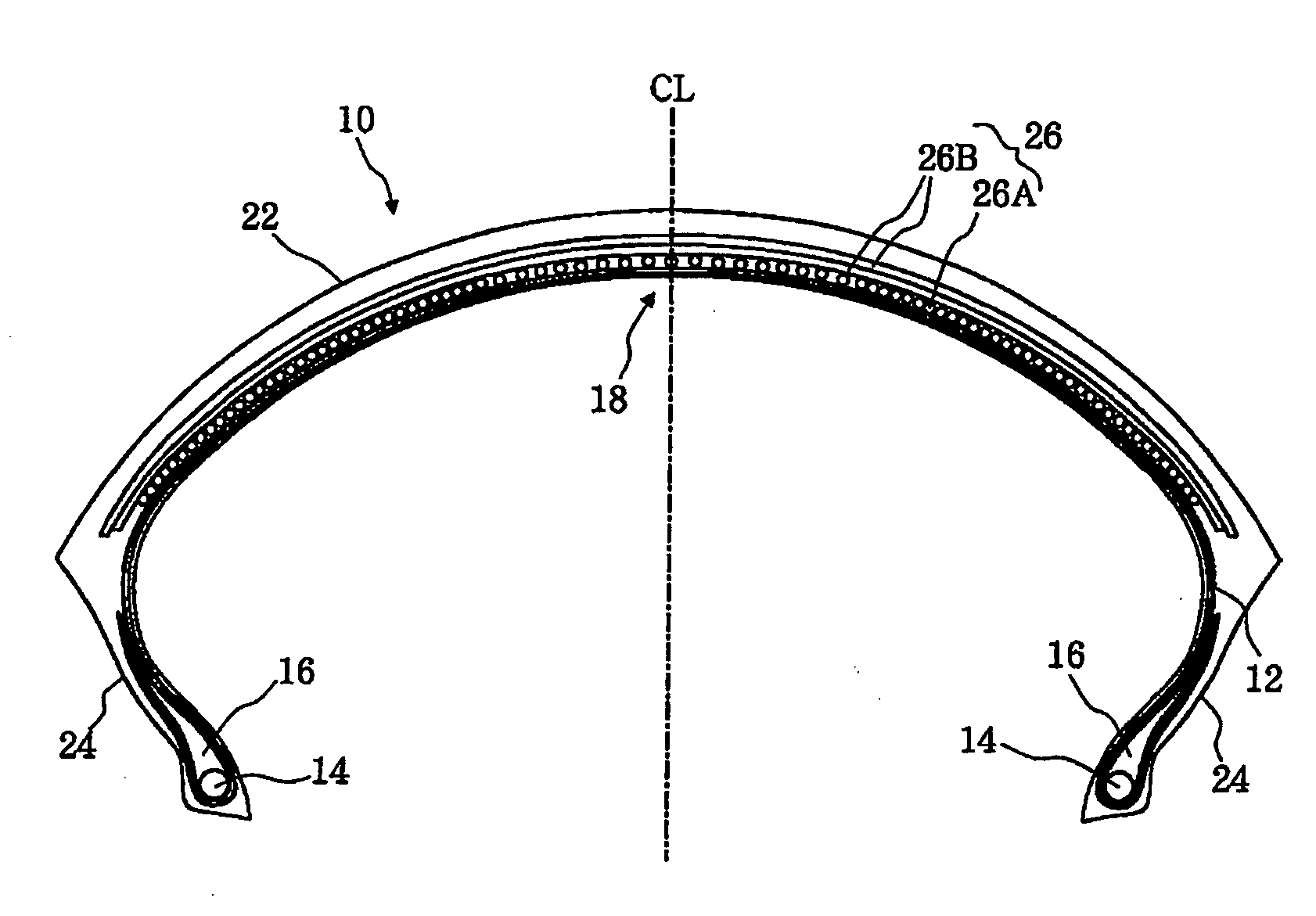

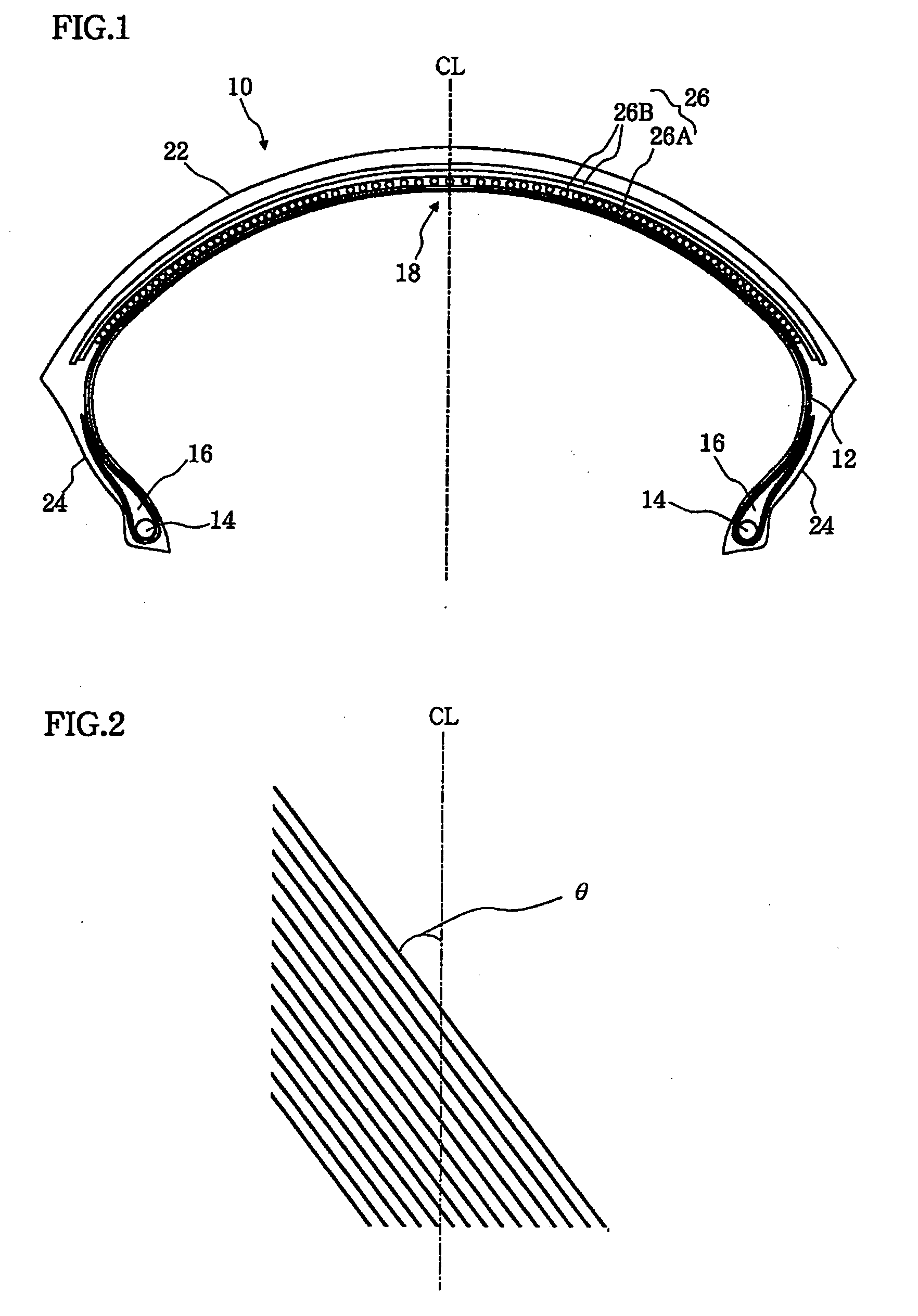

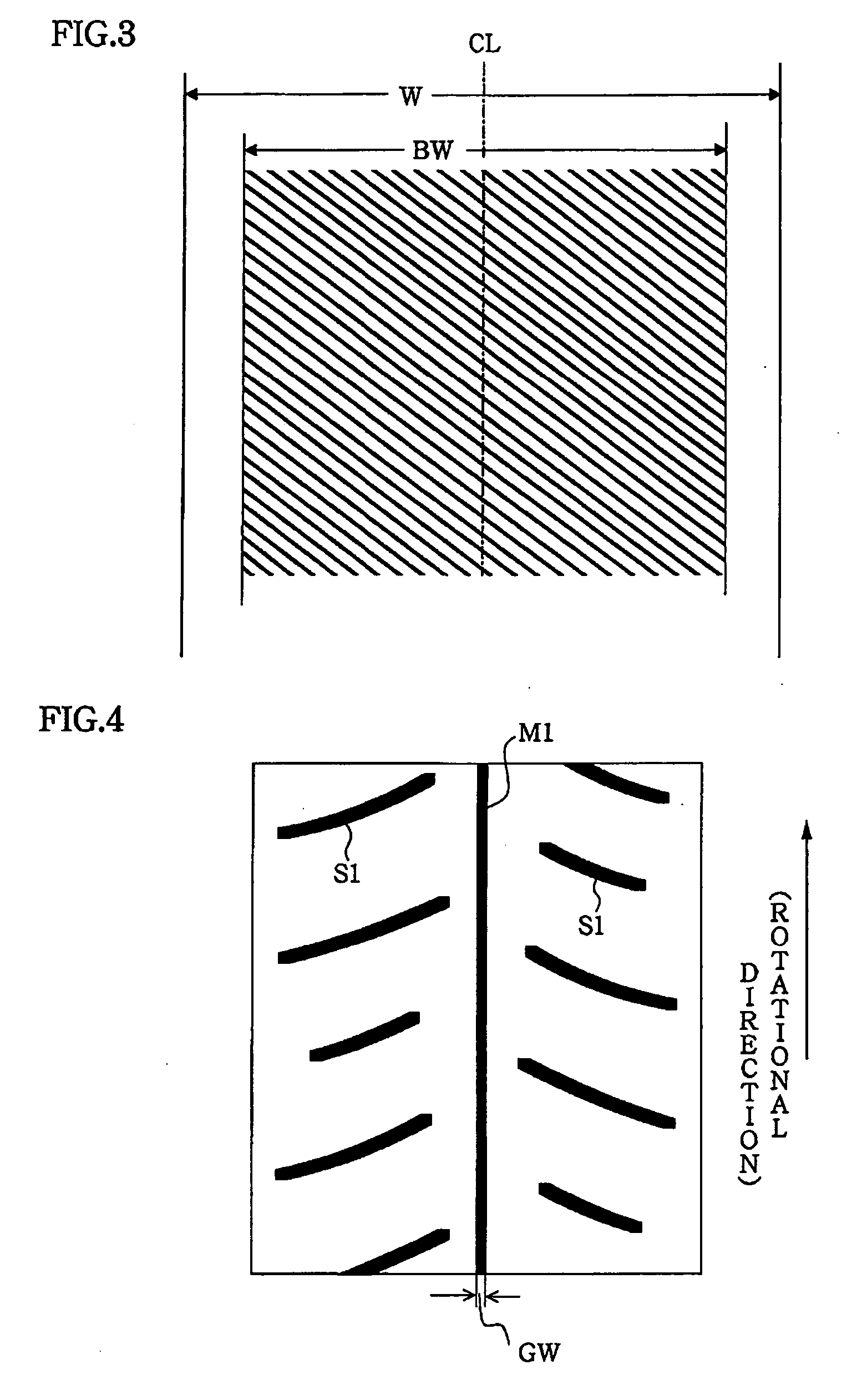

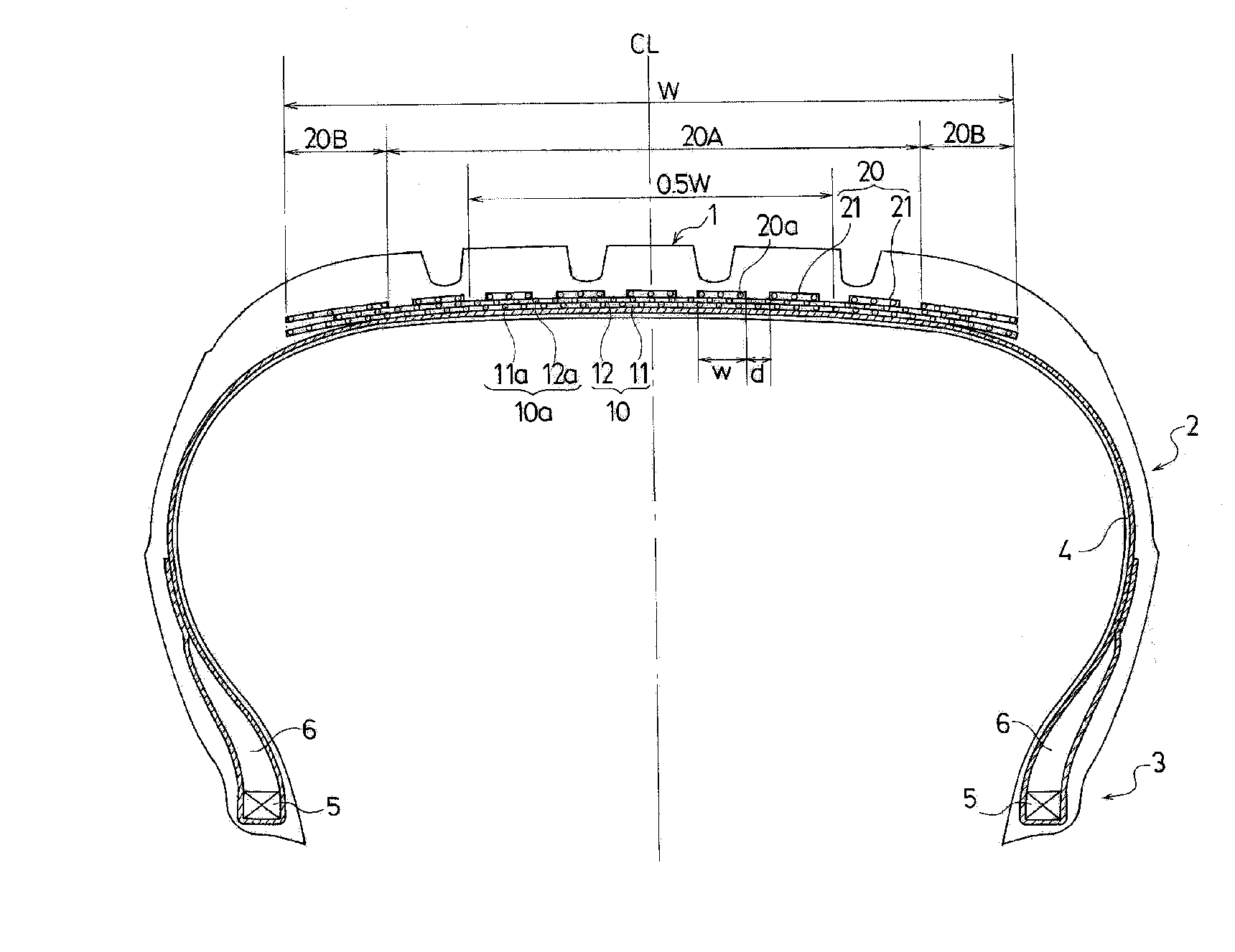

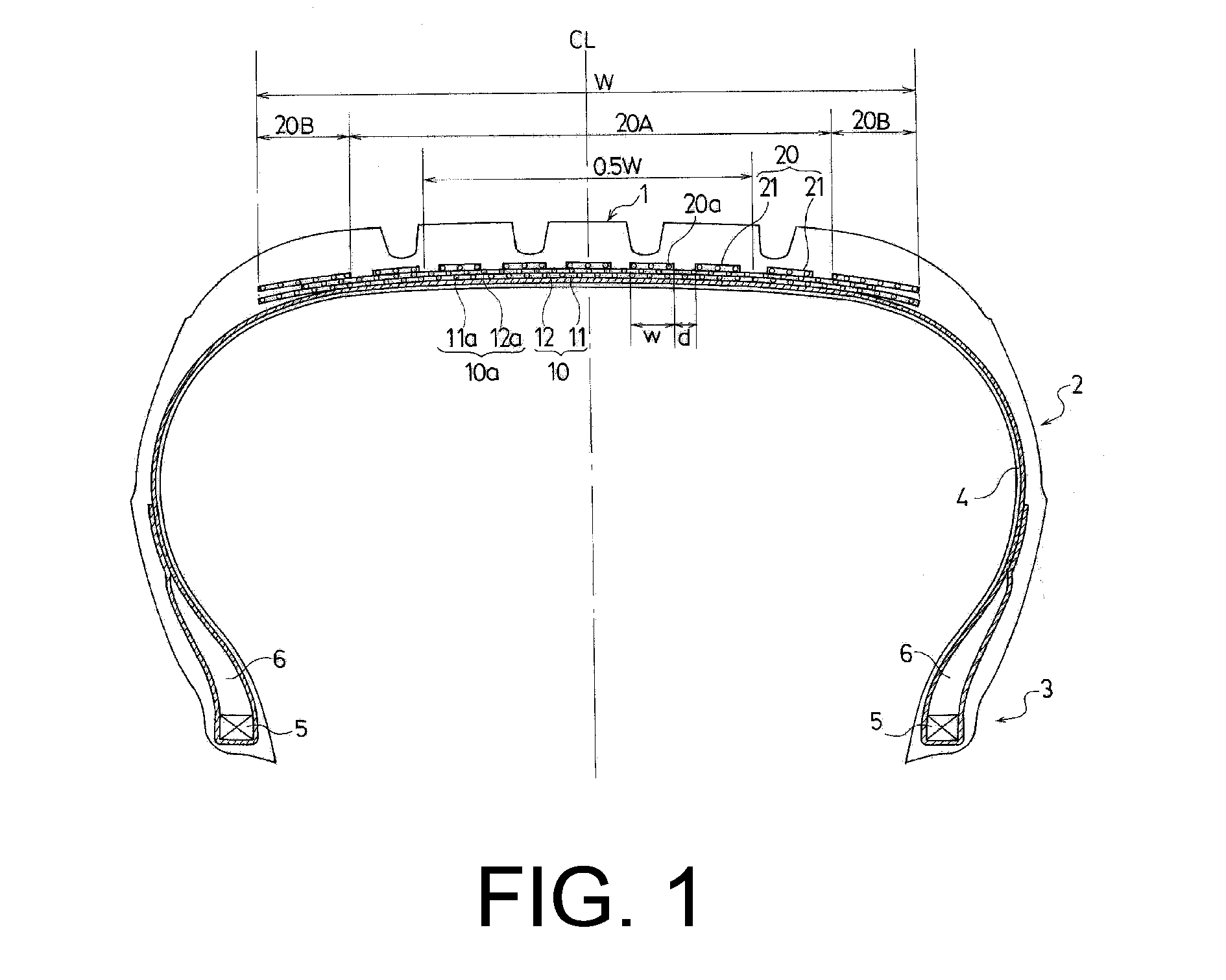

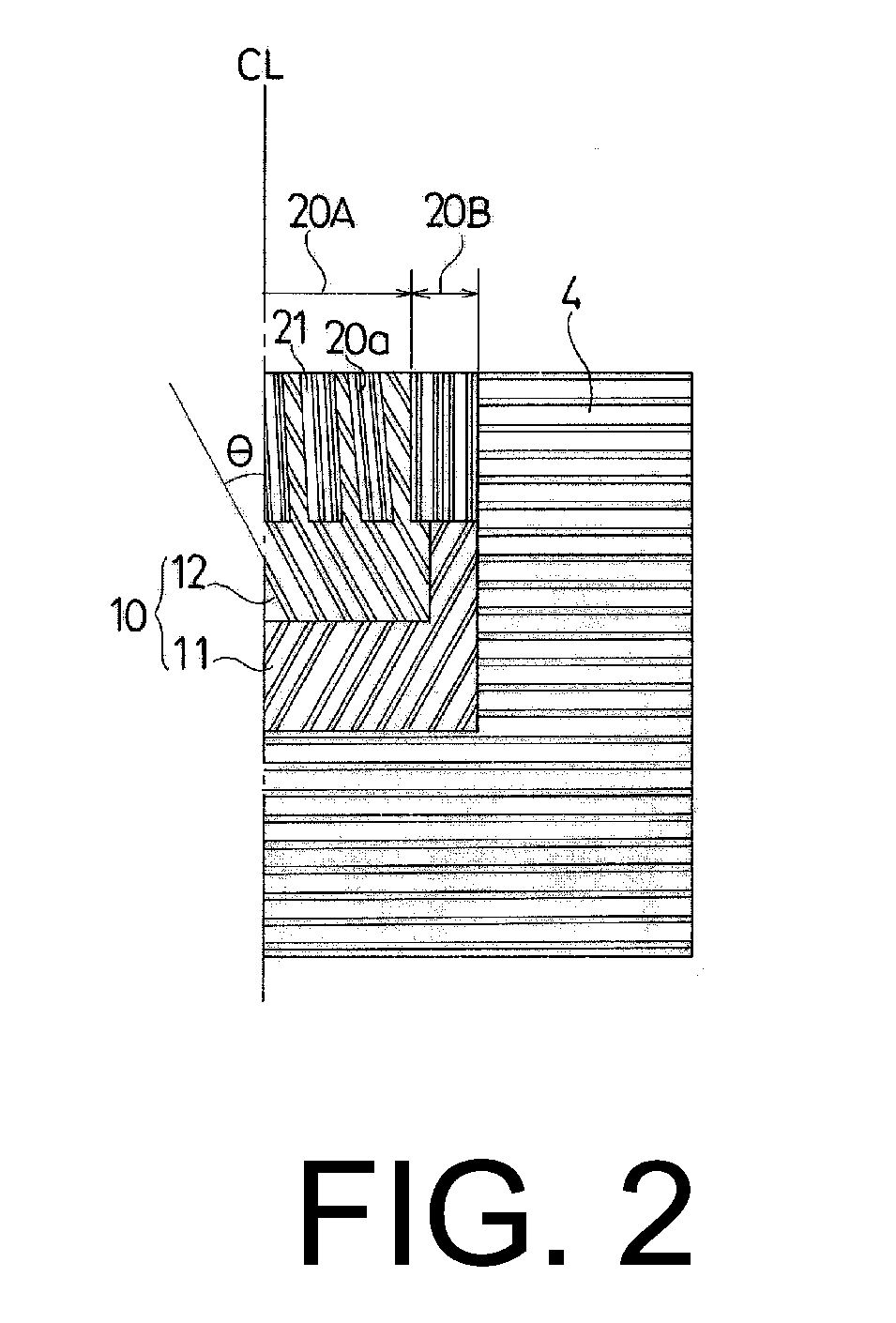

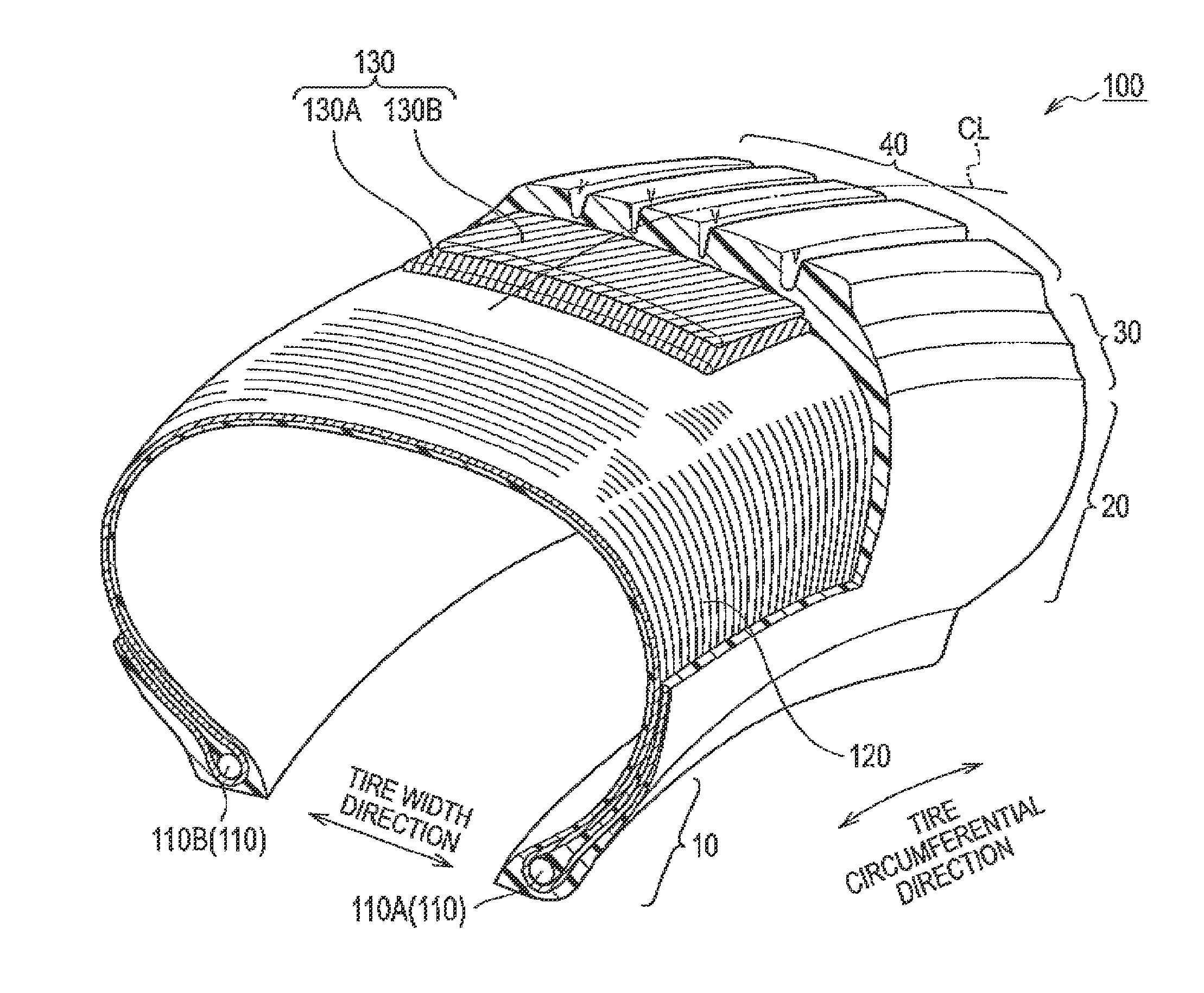

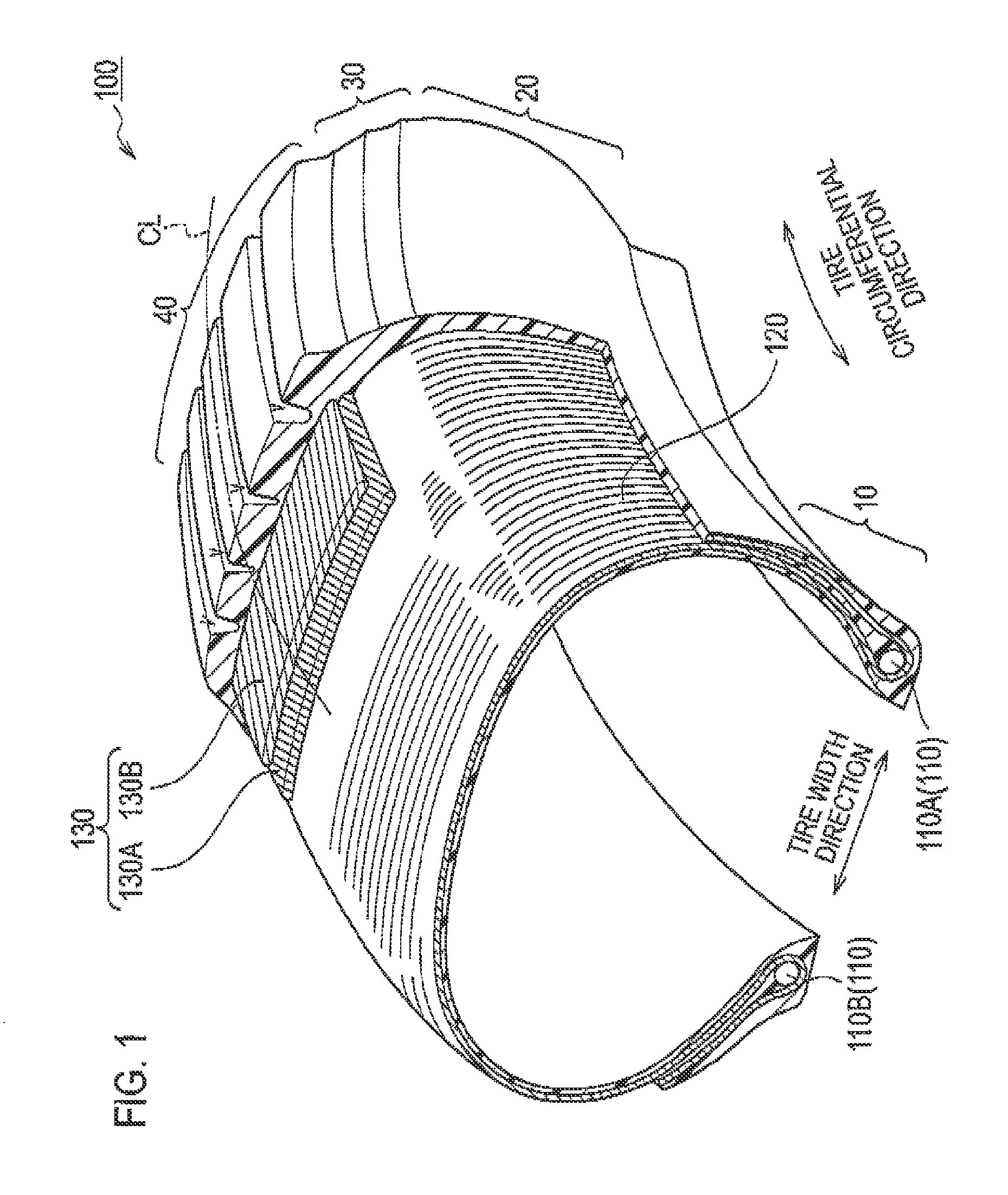

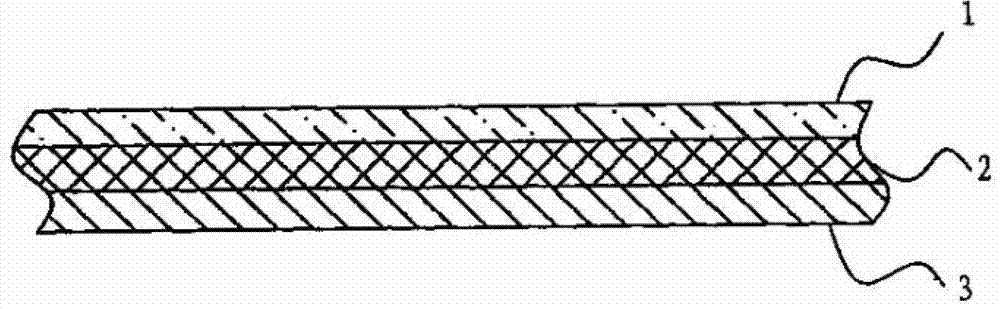

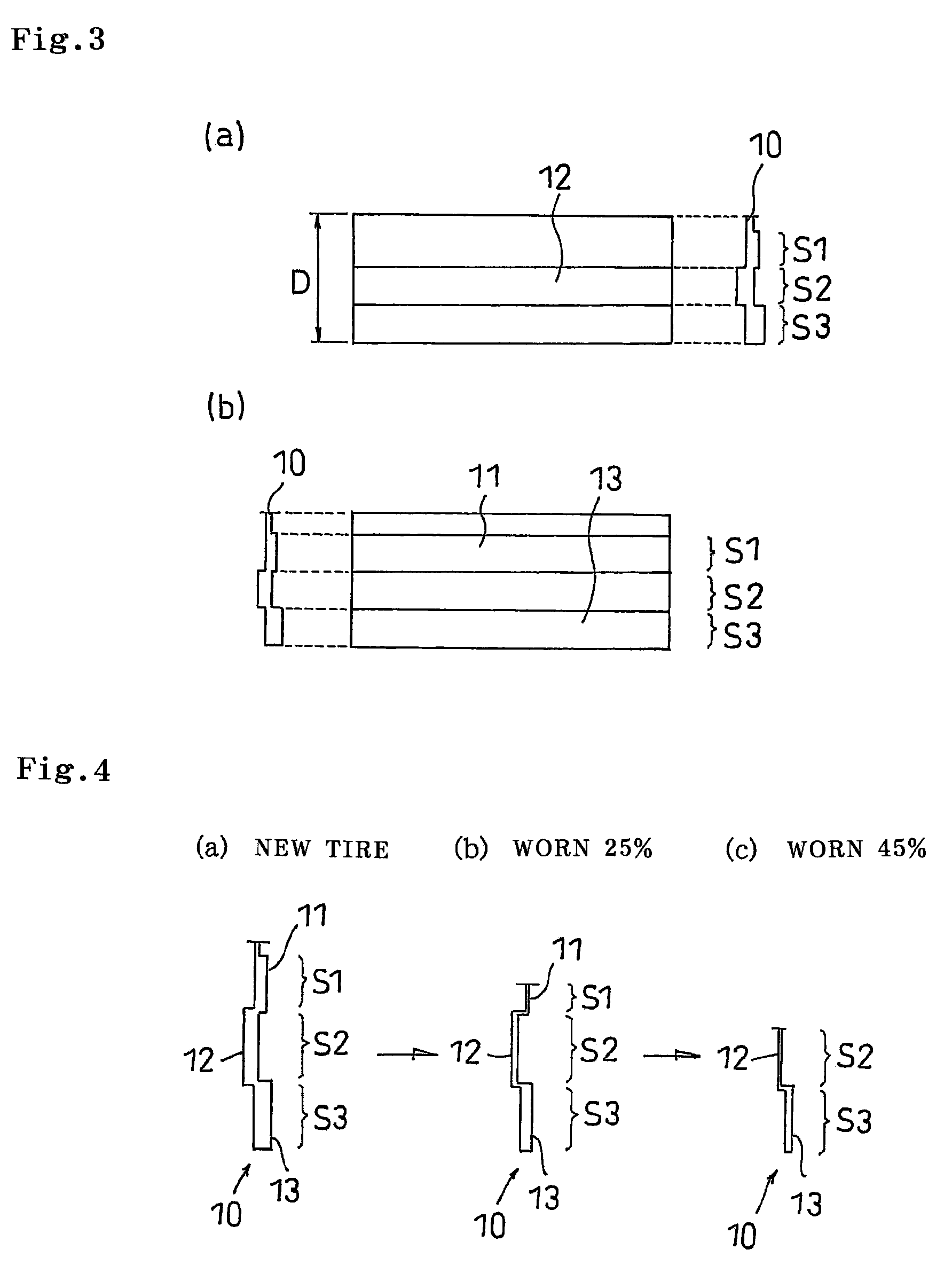

Pneumatic tire for two-wheeled motor vehicle

InactiveUS20060130949A1Improve cornering gripEnhancement of cornering grip performancePneumatic tyre reinforcementsMotorcycle tyresKinematicsRoad surface

A pneumatic tire for a two-wheeled motor vehicle in which a belt layer 26 includes a spiral belt (26A) where the direction of its cords is substantially a circumferential direction of the tire, and at least one angled belt (26B) that is provided on at least an outer layer of the spiral belt (26A) and whose cords have an angle with respect to an equatorial plane of the tire. On a tread surface portion of a tread (22) of the tire, there is provided, at least in a tread center region, a main groove component having an angle in the range of 0° or more to less than 20° with respect to the circumferential direction. Thus, a pneumatic tire for a two-wheeled motor vehicle is provided that is applicable to a front or rear wheel, and that possesses improved kinematical performance including the turning capability at a corner, grip limit, overall settling of vibrations of a vehicle body, slip-control performance, capability of absorbing unevenness of a road surface, and enhanced steering stability, which are realized by making use of respective advantageous characteristics of the respective belts.

Owner:BRIDGESTONE CORP

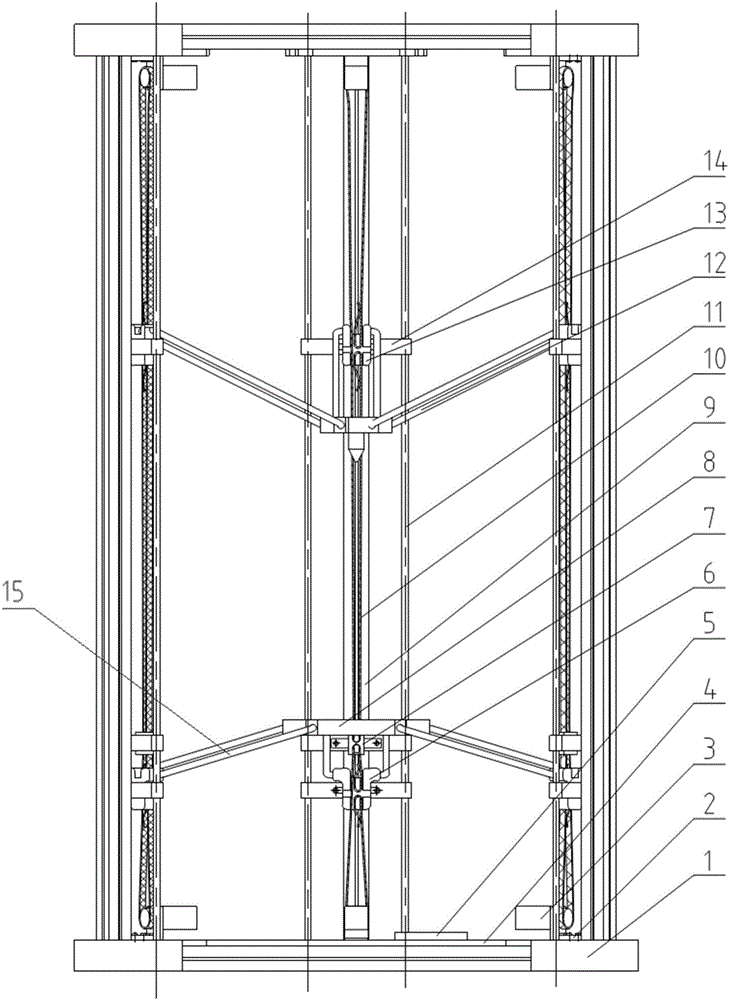

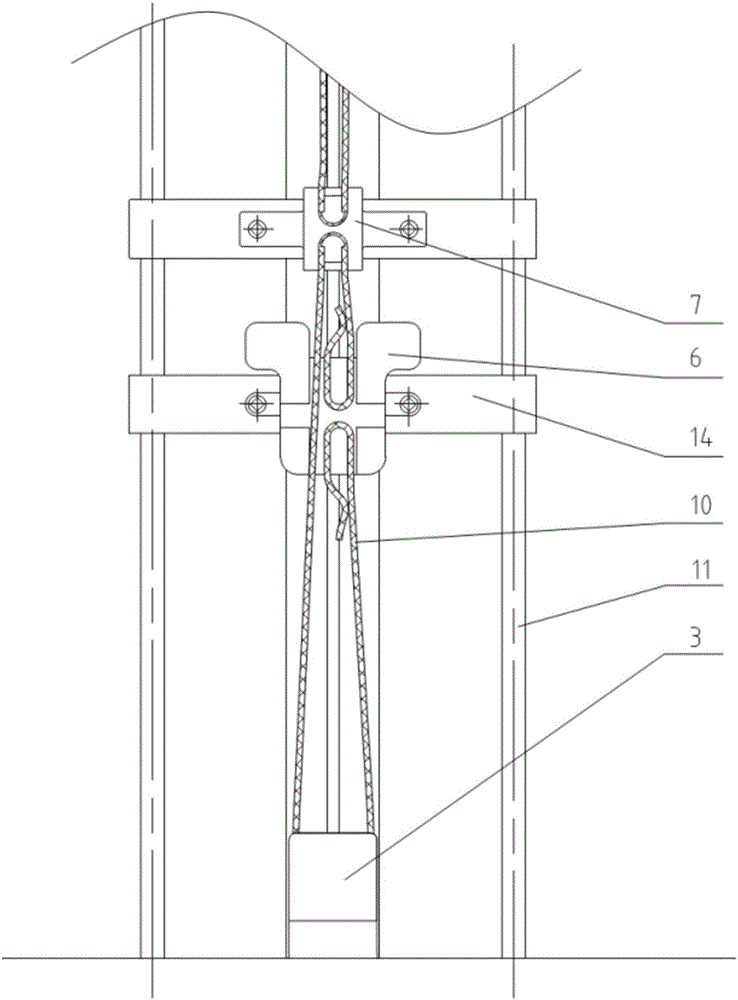

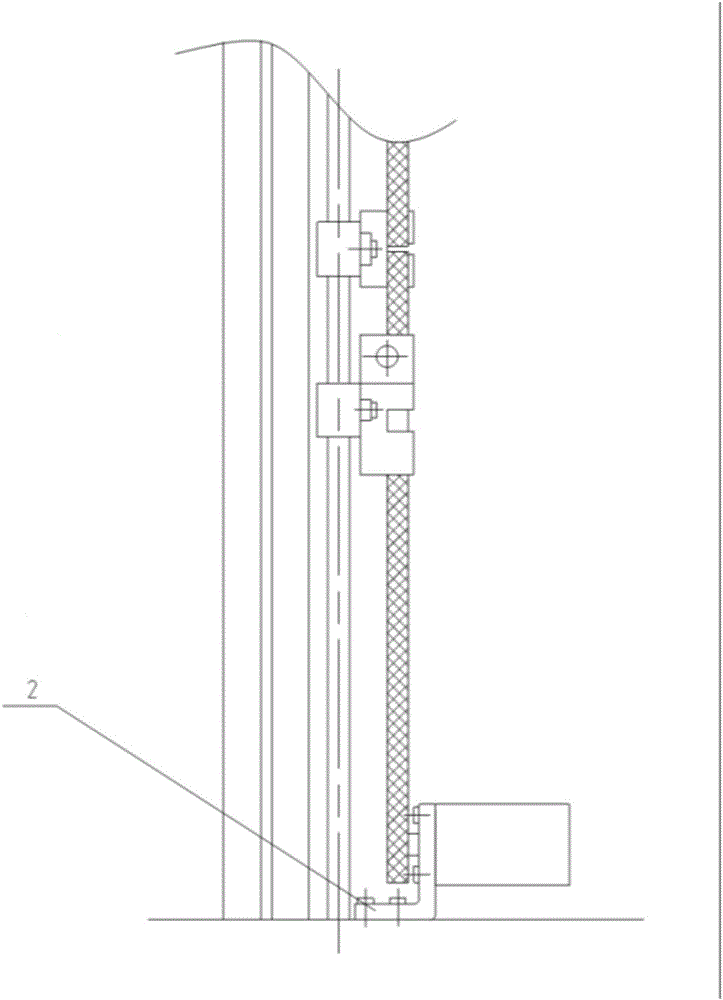

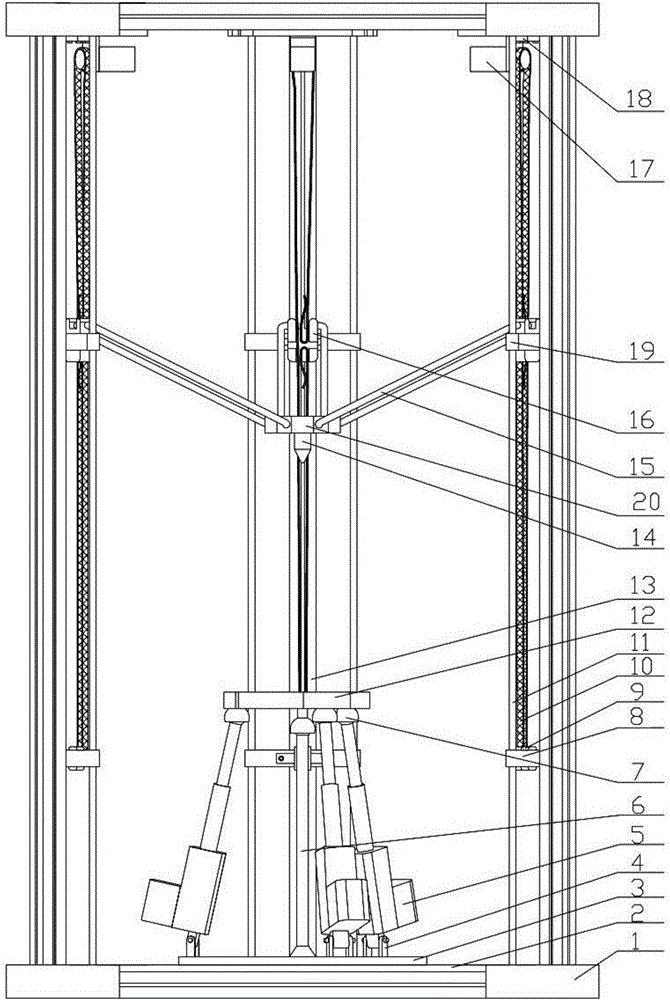

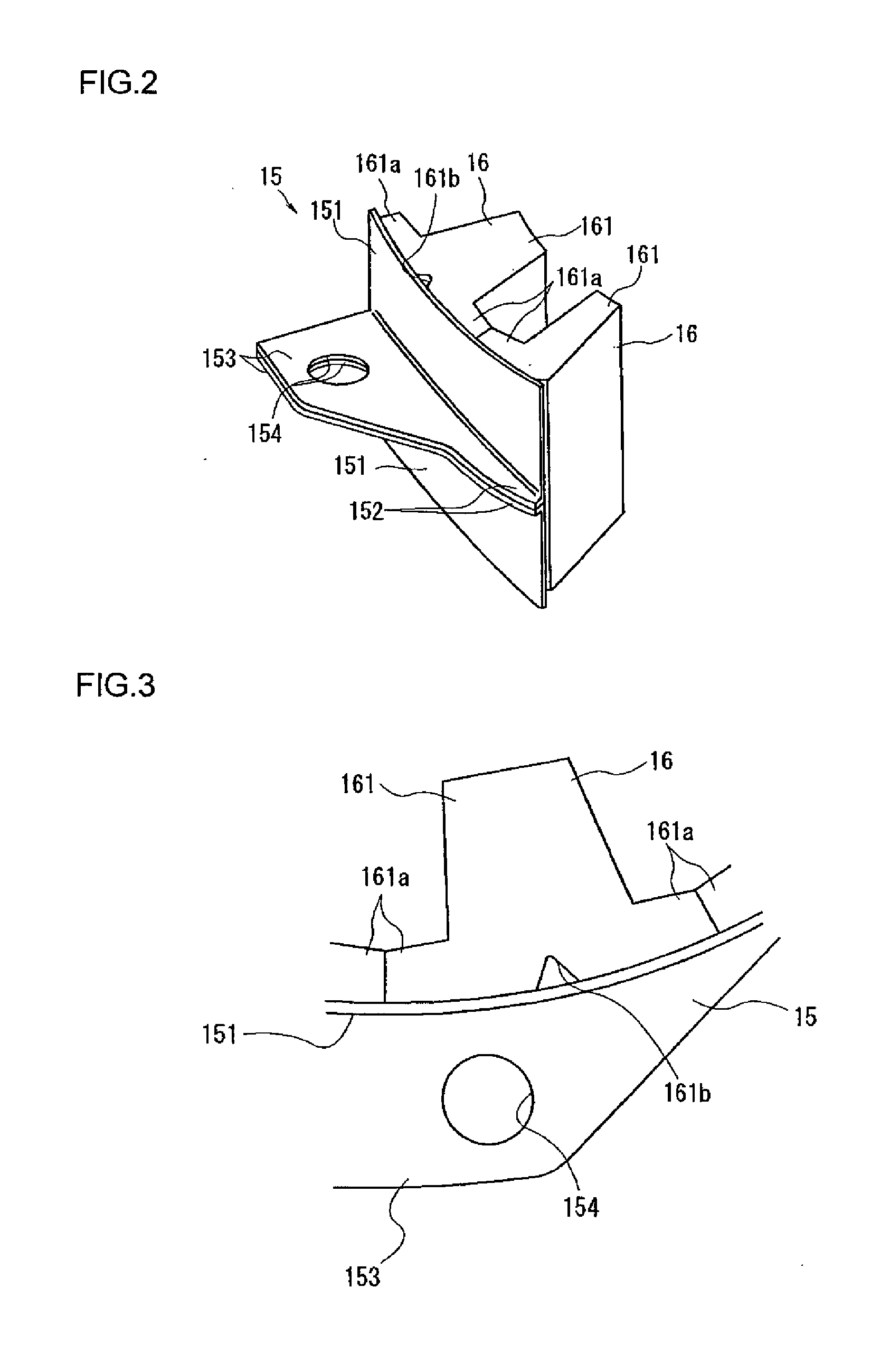

3D printer with hook face processing characteristic

InactiveCN105773984AImprove printing accuracyImprove printing efficiencyAdditive manufacturing apparatusIncreasing energy efficiencySprayerEngineering

The invention discloses a 3D printer with the hook face processing characteristic and belongs to the technical field of digital processing. The 3D printer with the hook face processing characteristic solves the gravity limitation problem caused by a cantilever and a hollow structure in workpiece design engineering, can achieve hook face 3D printing and structurally comprises a fixing framework, a work platform, a parallel connection rod movement sprayer, stepping motors and a synchronous belt. The work platform is inclined through the stepping motors and the synchronous belt. According to the 3D printer, by means of inclination of a machine base platform and movement of a nozzle on a 3D printer body, workpiece cantilever printed pieces and cavity hook face printed pieces can be printed without supporting matter. The 3D printer with the hook face processing characteristic can perform direct printing on a hollow polyhedron, a multilayer cellular structure workpiece and a hook surface workpiece, and the 3D printing efficiency is improved.

Owner:JILIN UNIV

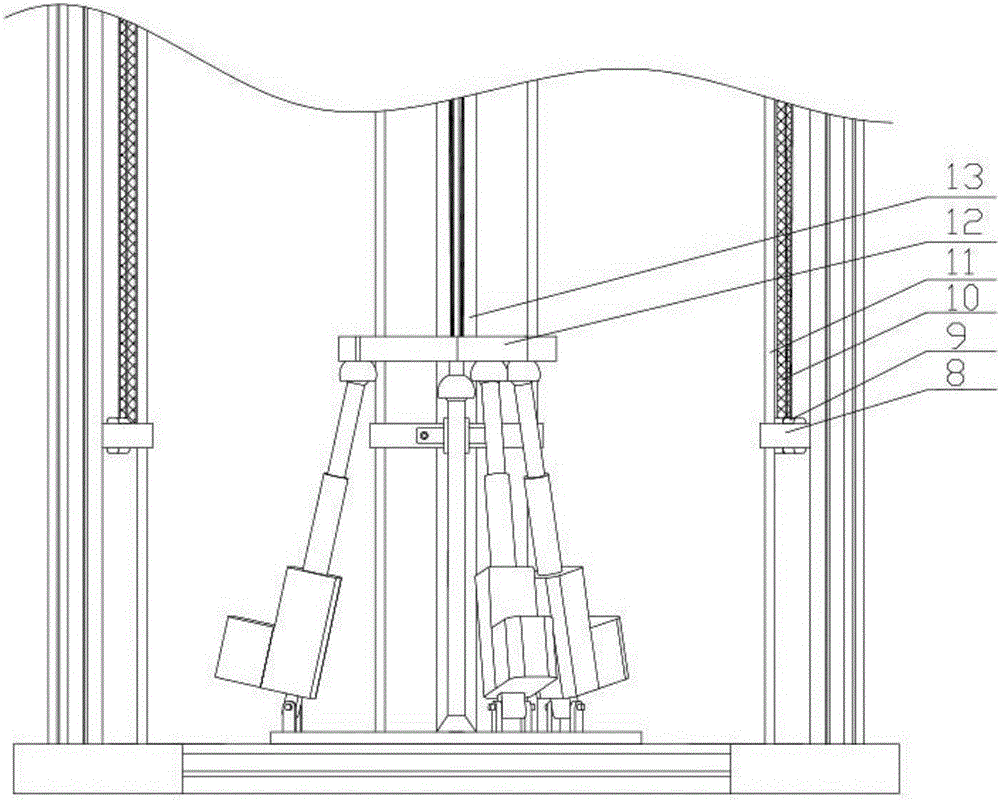

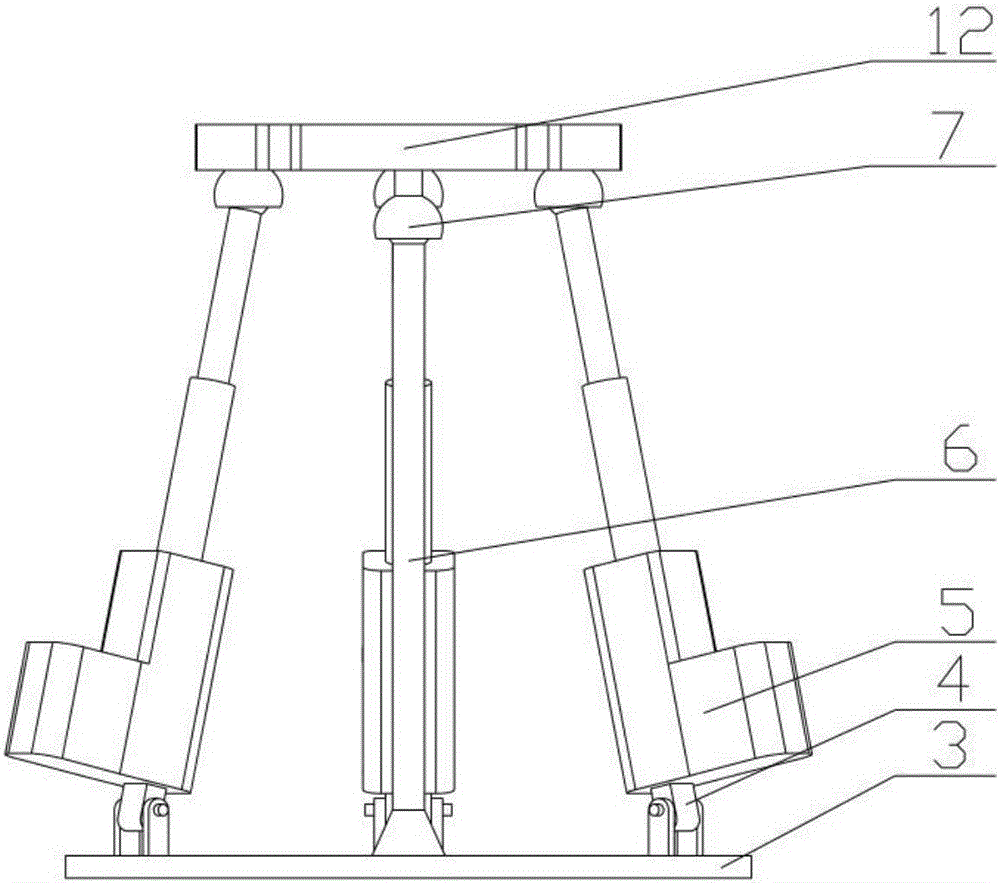

3D printing machine with inclinable working platform

InactiveCN105818393AImprove printing accuracyImprove printing efficiencyAdditive manufacturing apparatusEngineering3d printer

The invention discloses a 3D printing machine with an inclinable working platform, and belongs to the technical field of digital machining. The 3D printing machine is a five-shaft linkage 3D printing device based on a parallel mechanism. The working platform is inclined through electric push rods and spherical hinge structures; and the electric push rods are hinged to a lower platform adopted as a static platform of the parallel mechanism through hooke joints to form a 3-PRS parallel mechanism. According to the 3D printing machine with the inclinable working platform, the defects of a traditional two-shaft or three-shaft linkage 3D printing machine are overcome, the printing efficiency is greatly improved through five-shaft linkage, the gravity limit problem caused by a cantilever and a hollow structure during workpiece design engineering is solved, hollow polyhedrons, multi-layer honeycomb structure workpieces and curved surface workpieces can be directly printed through the 3D printing machine, and the 3D printing efficiency is improved.

Owner:JILIN UNIV

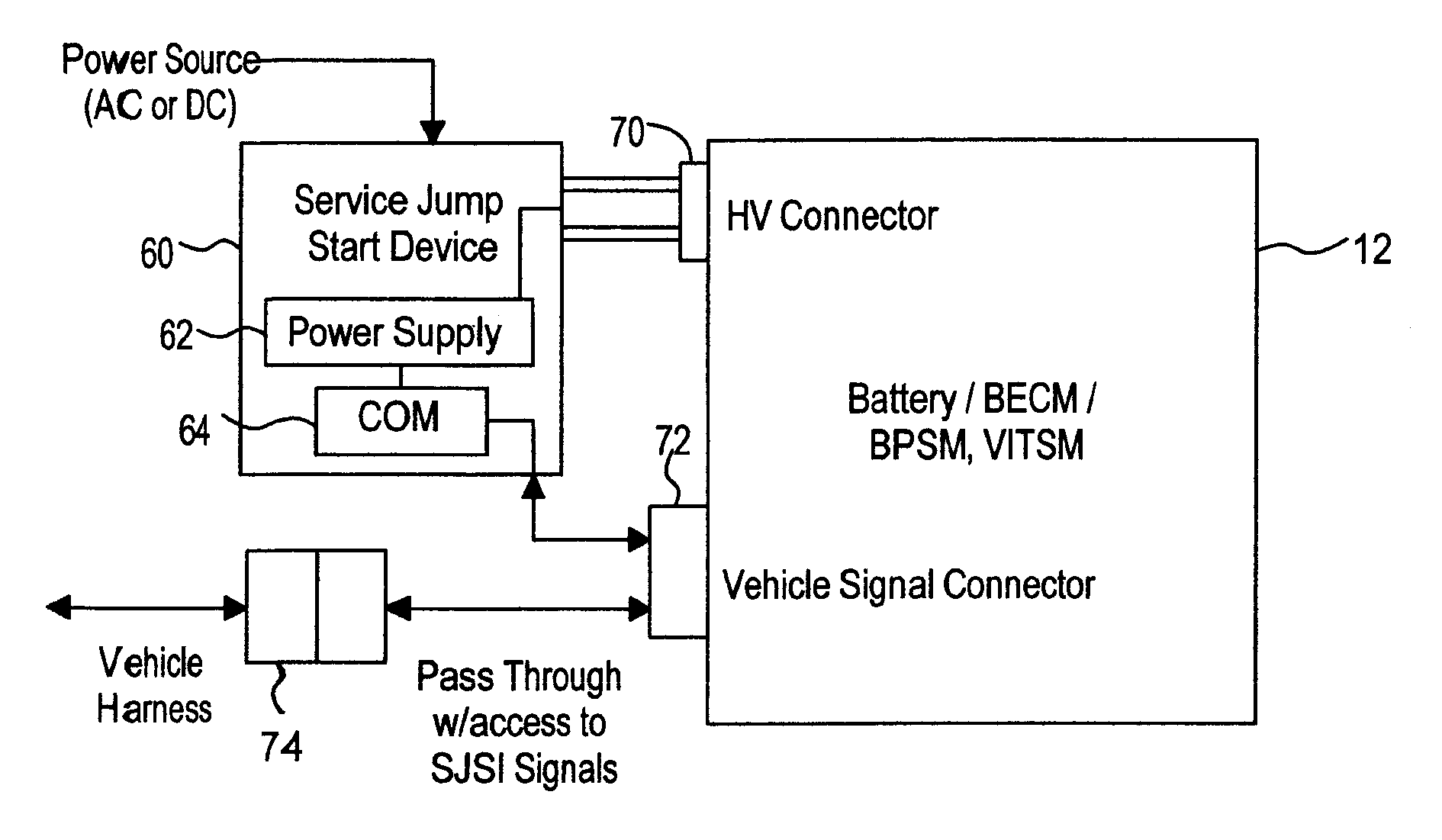

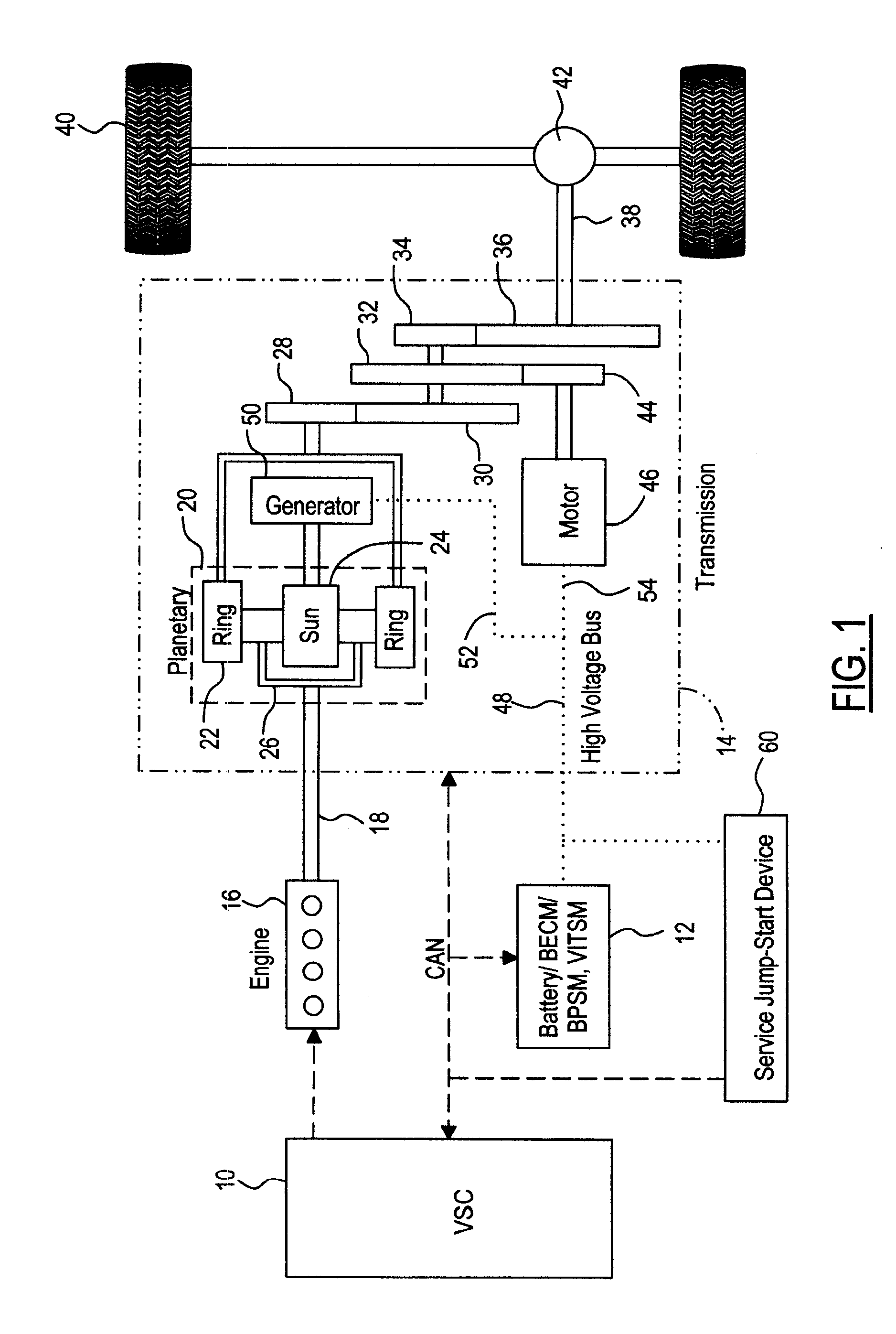

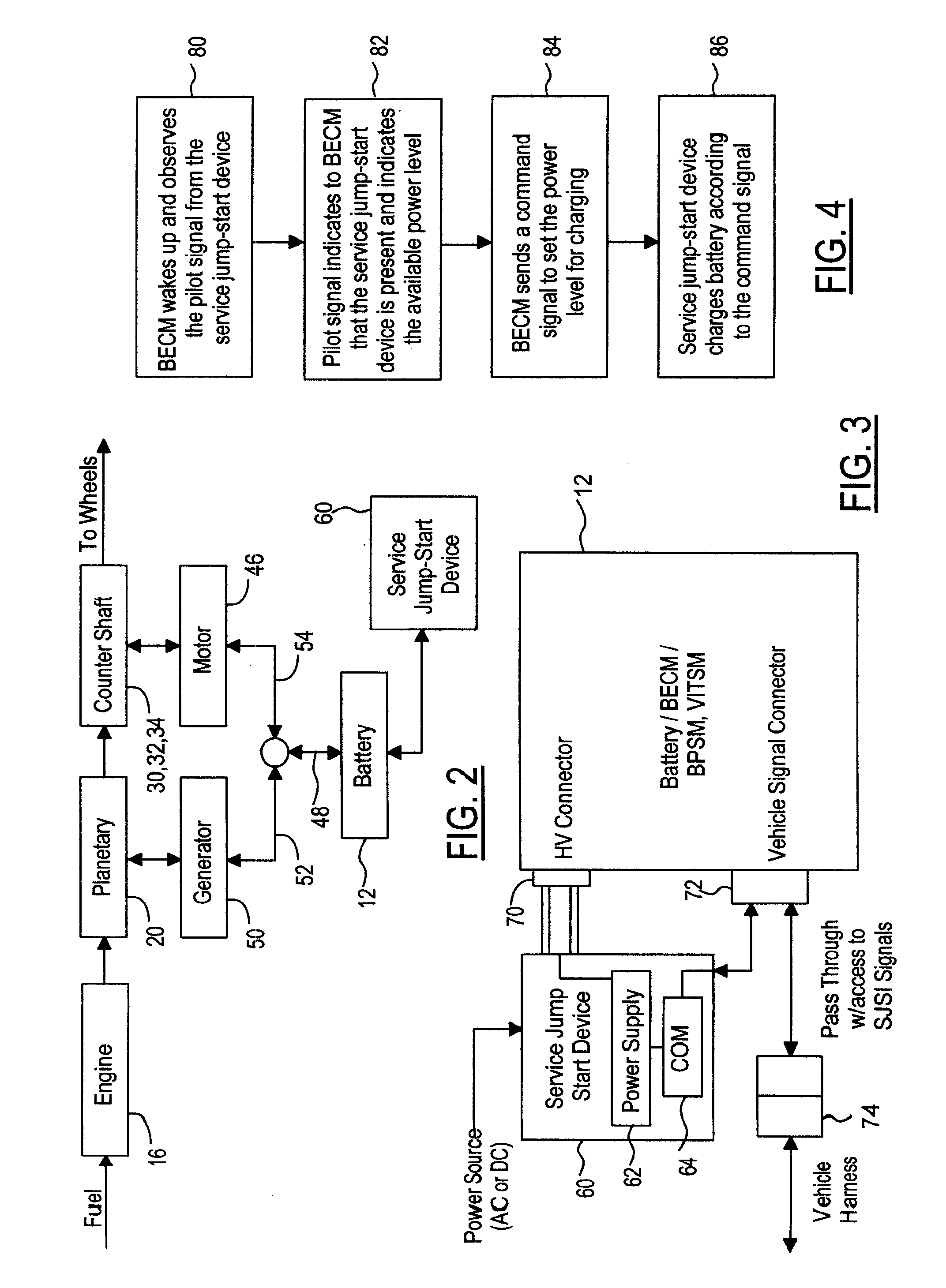

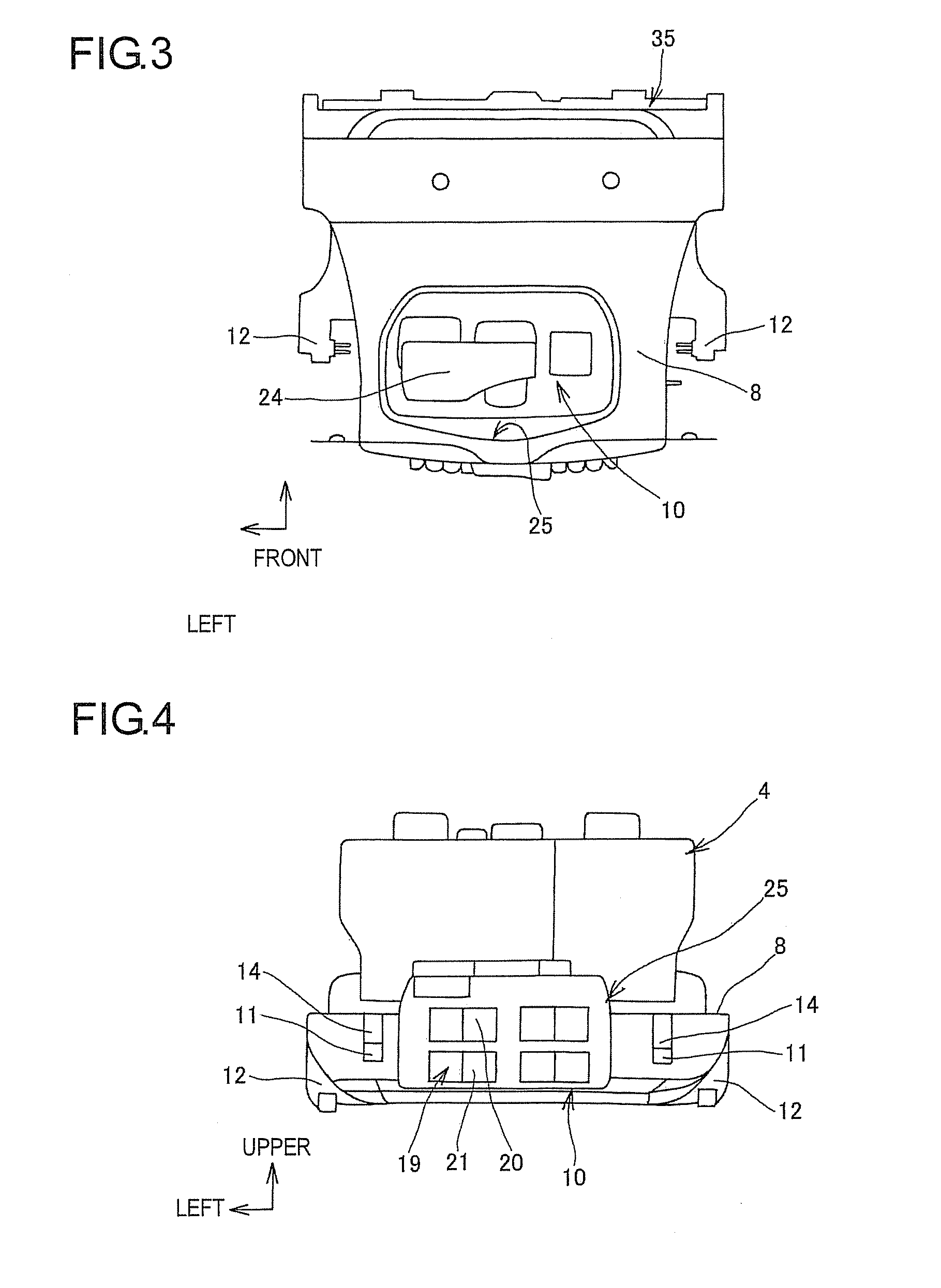

Service jump-start device for hybrid electric vehicles

InactiveUS20080100259A1Avoids rigidityAvoid complexityBatteries circuit arrangementsPropulsion using engine-driven generatorsCommunication interfacePowertrain

A hybrid electric vehicle includes an internal combustion engine, a traction battery, and a hybrid electric powertrain. A compact, portable, off board service jump-start device provides direct current (DC) power at a proper voltage and current to recharge the traction battery. The device includes a power supply with a high voltage output for providing the DC power. The device further includes a communication interface for receiving commands to control the recharging of the traction battery. The power supply recharges the traction battery in accordance with the received commands. Advantageously, this provides a compact, portable, off board service jump-start device that provides a controlled recharging of the traction battery of the hybrid electric vehicle and allows charging of the traction battery without the need for charging circuits on the vehicle.

Owner:FORD GLOBAL TECH LLC

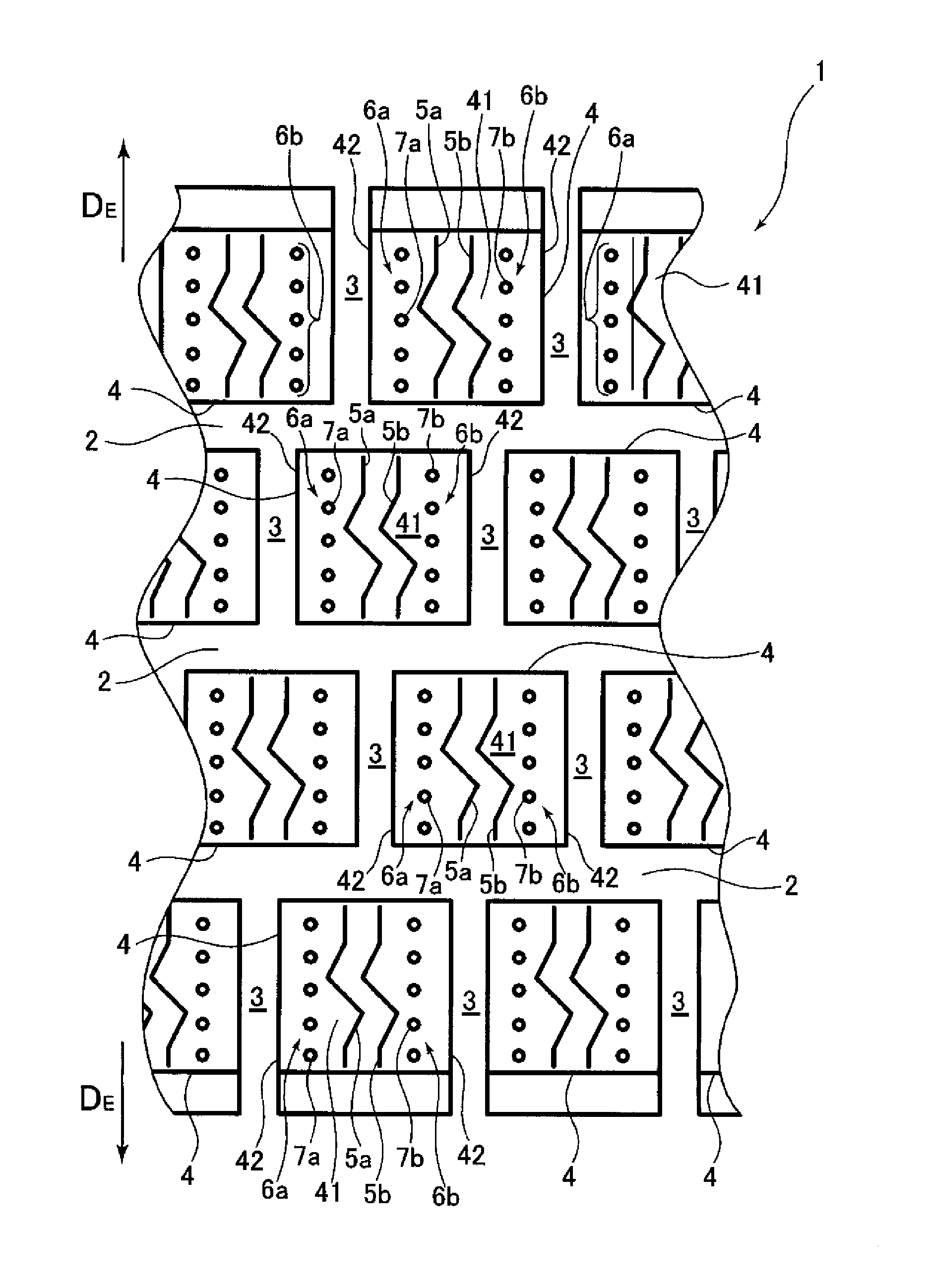

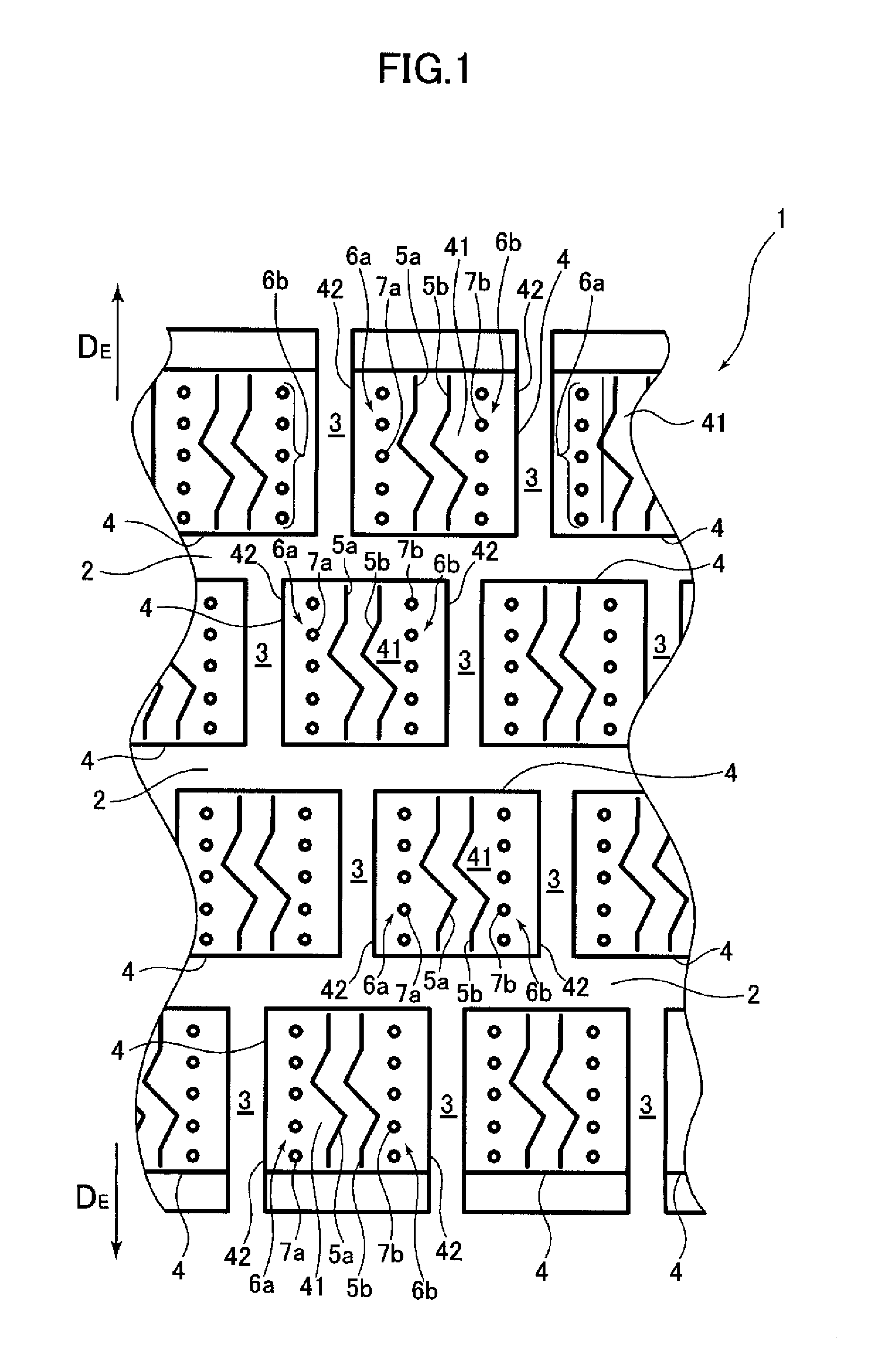

Tread for winter-use pneumatic tires

InactiveUS20130186533A1Increased durabilityHeat generationTyre tread bands/patternsNon-skid devicesGround contactTread

To provide a winter-use pneumatic tire with which the performance on ice can be enhanced and tread pattern durability can be enhanced. The tread for a winter-use pneumatic tire according to the present invention has blocks which are aligned in the circumferential direction and in which are formed respectively at least one thin incision which extends substantially parallel to a circumferential direction edge and which has a widened portion at its bottom, and at least one series of small holes comprising at least two small holes which open in a ground contacting surface of the block and extend in the inward radial direction of the tire, and the at least one series of small holes is formed in a neighboring region of the circumferential direction edge, and is formed in an intermediate portion between the circumferential direction edge and the at least one thin incision.

Owner:MICHELIN & CO CIE GEN DES ESTAB MICHELIN +1

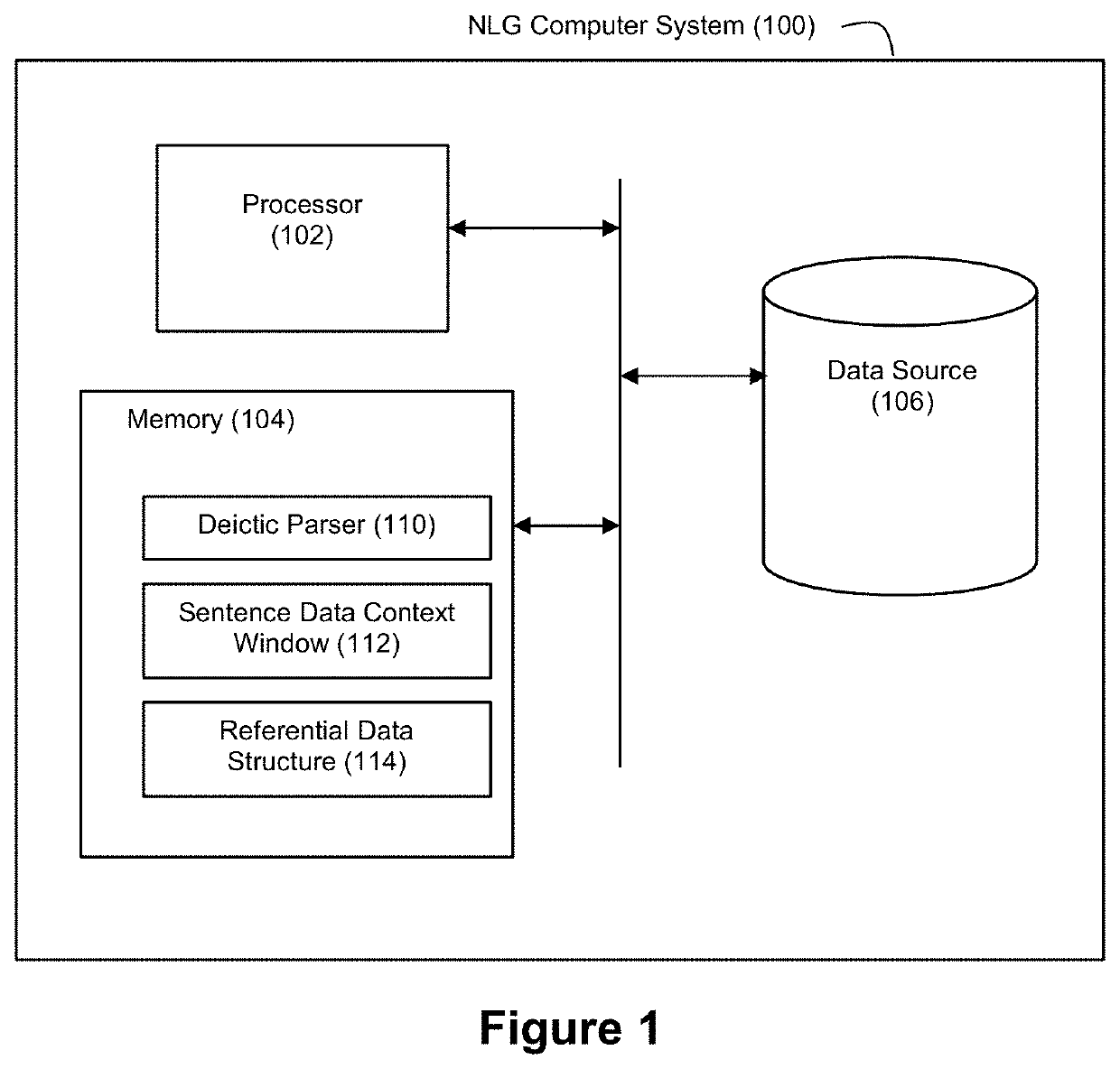

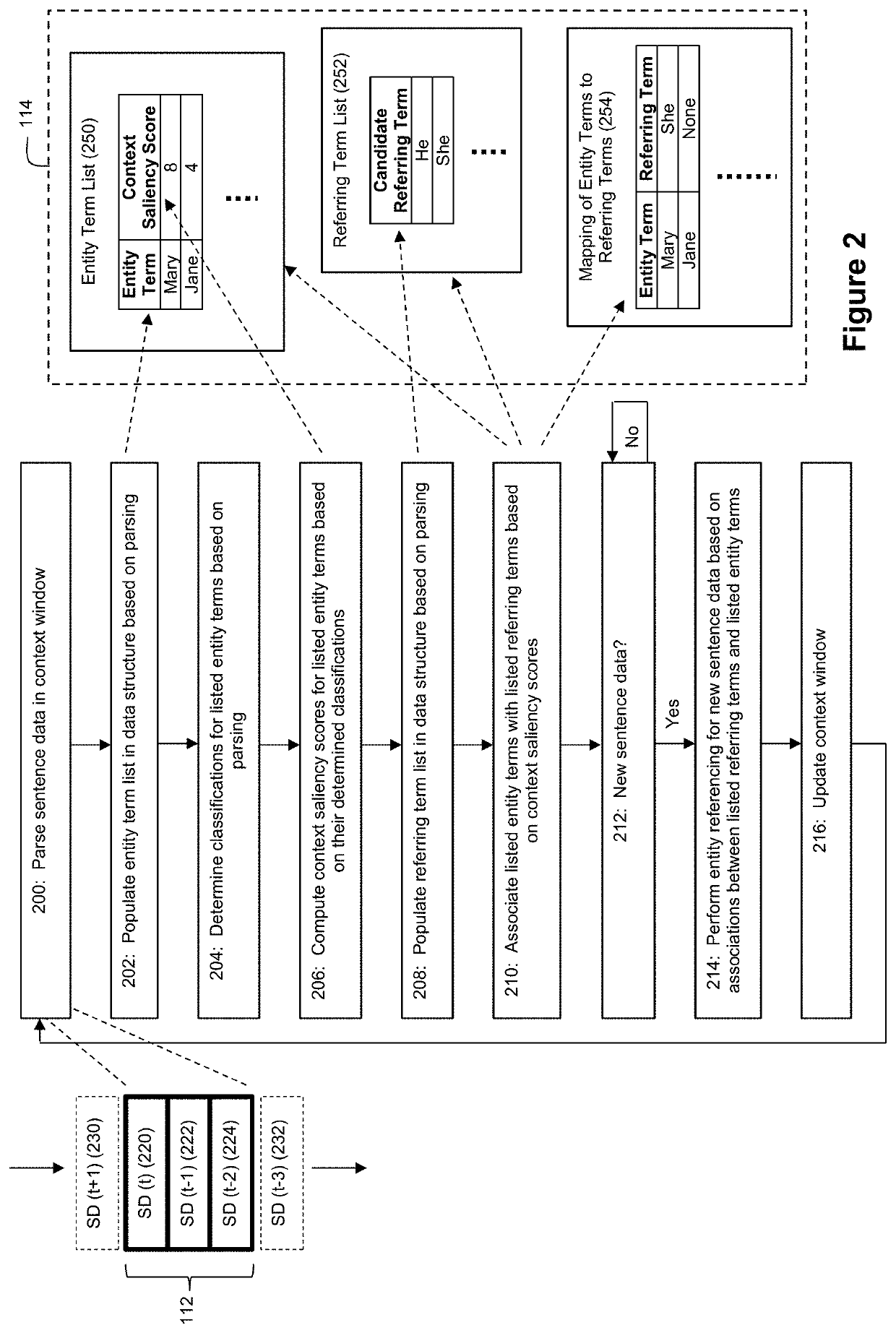

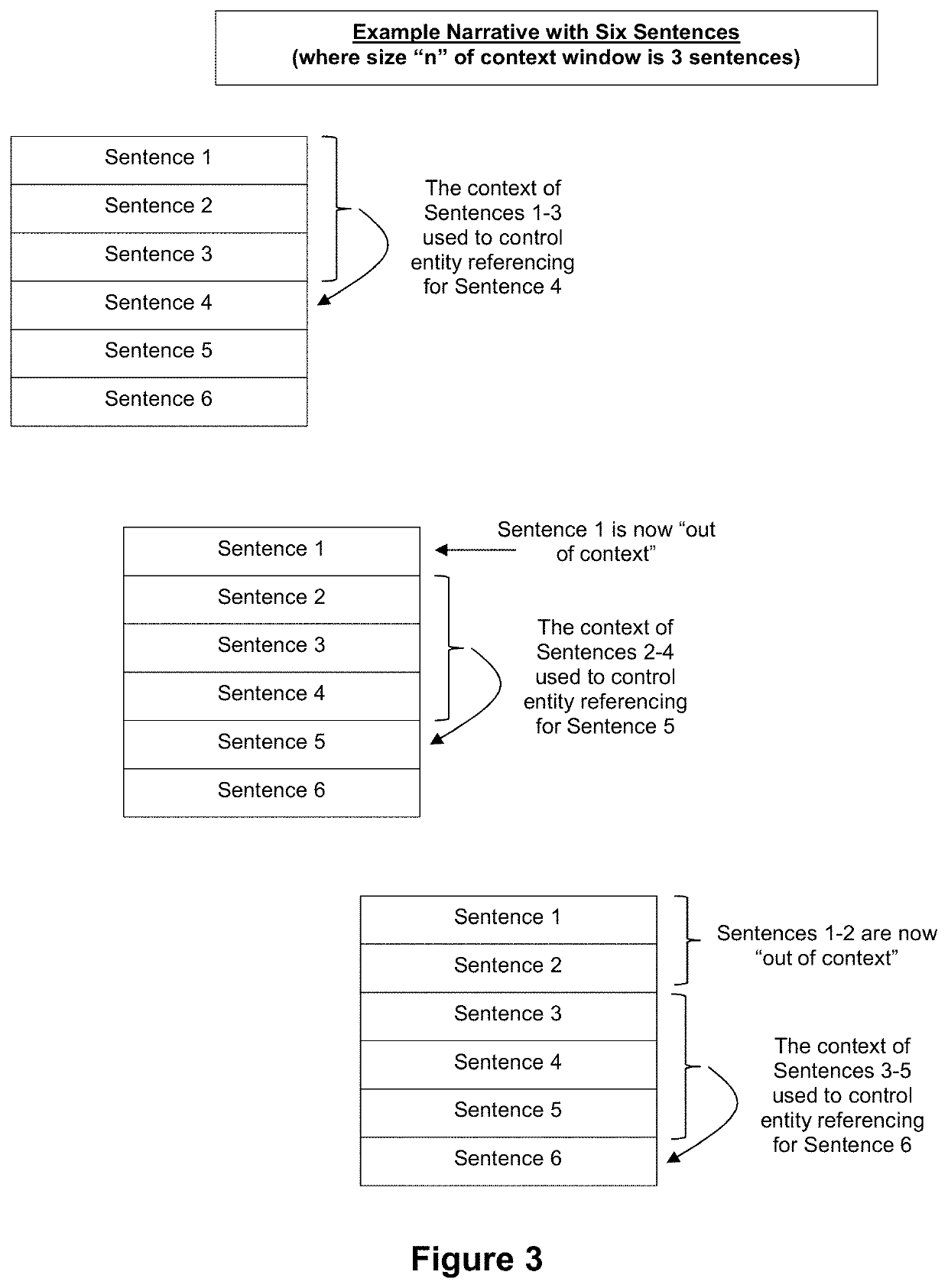

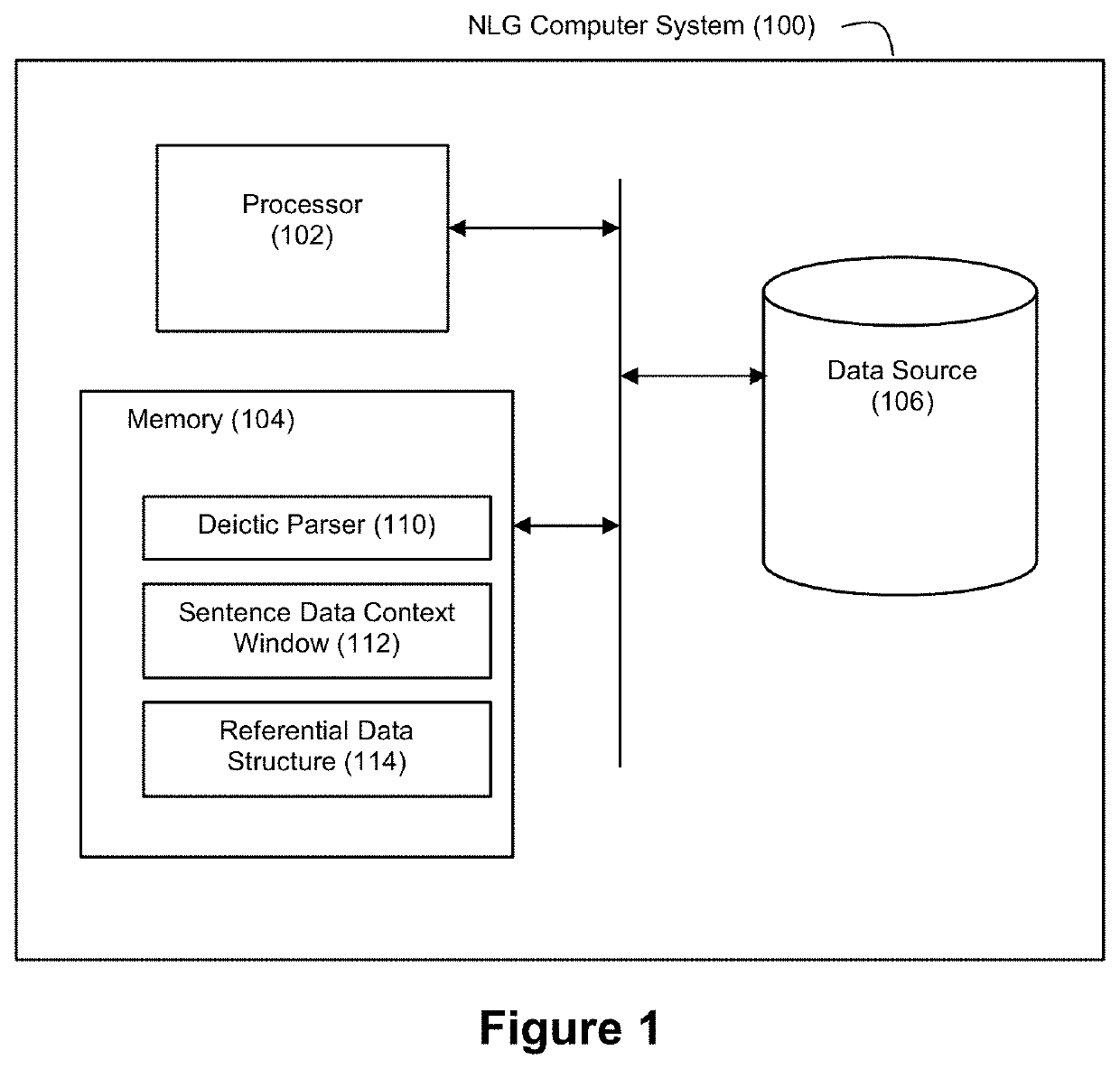

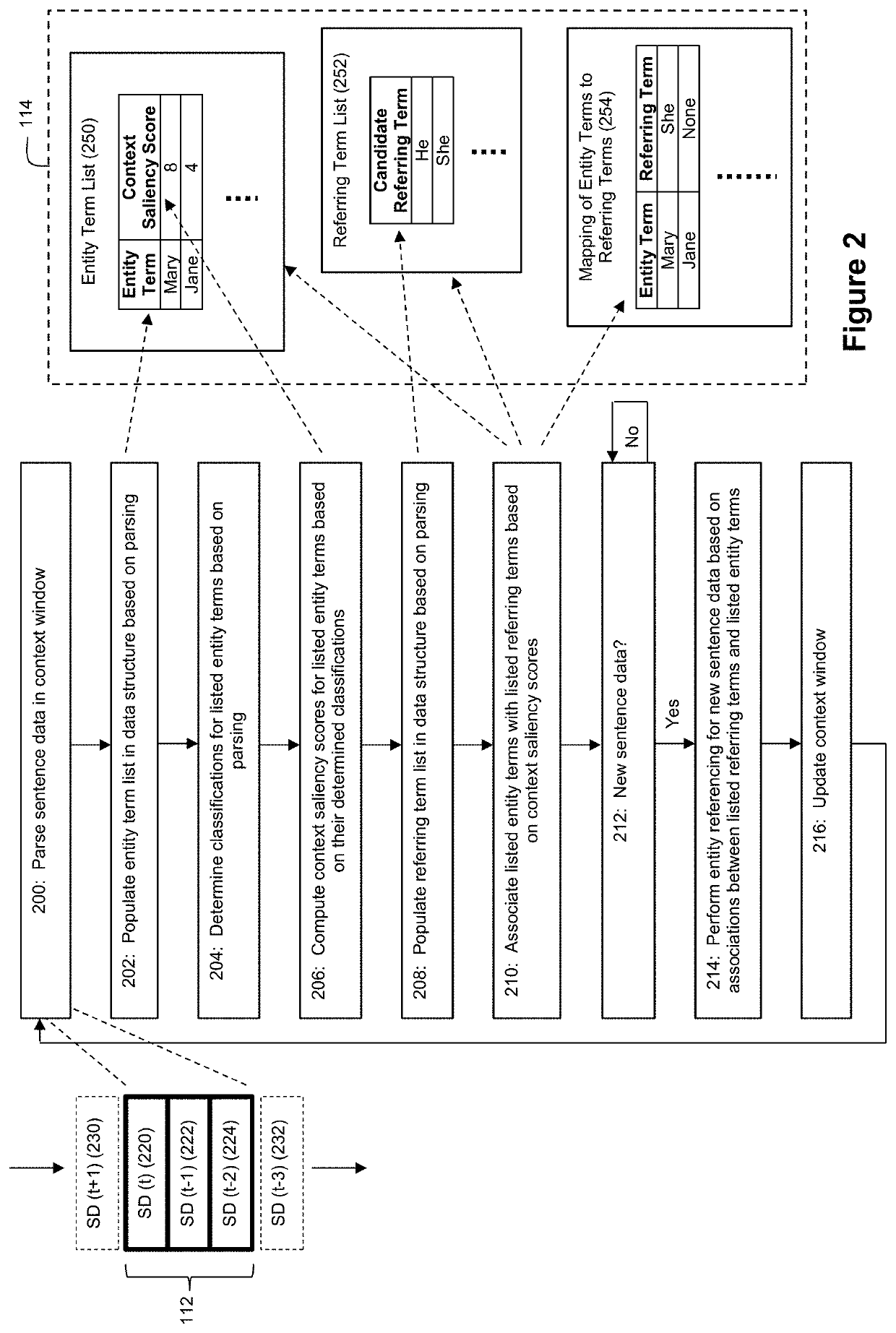

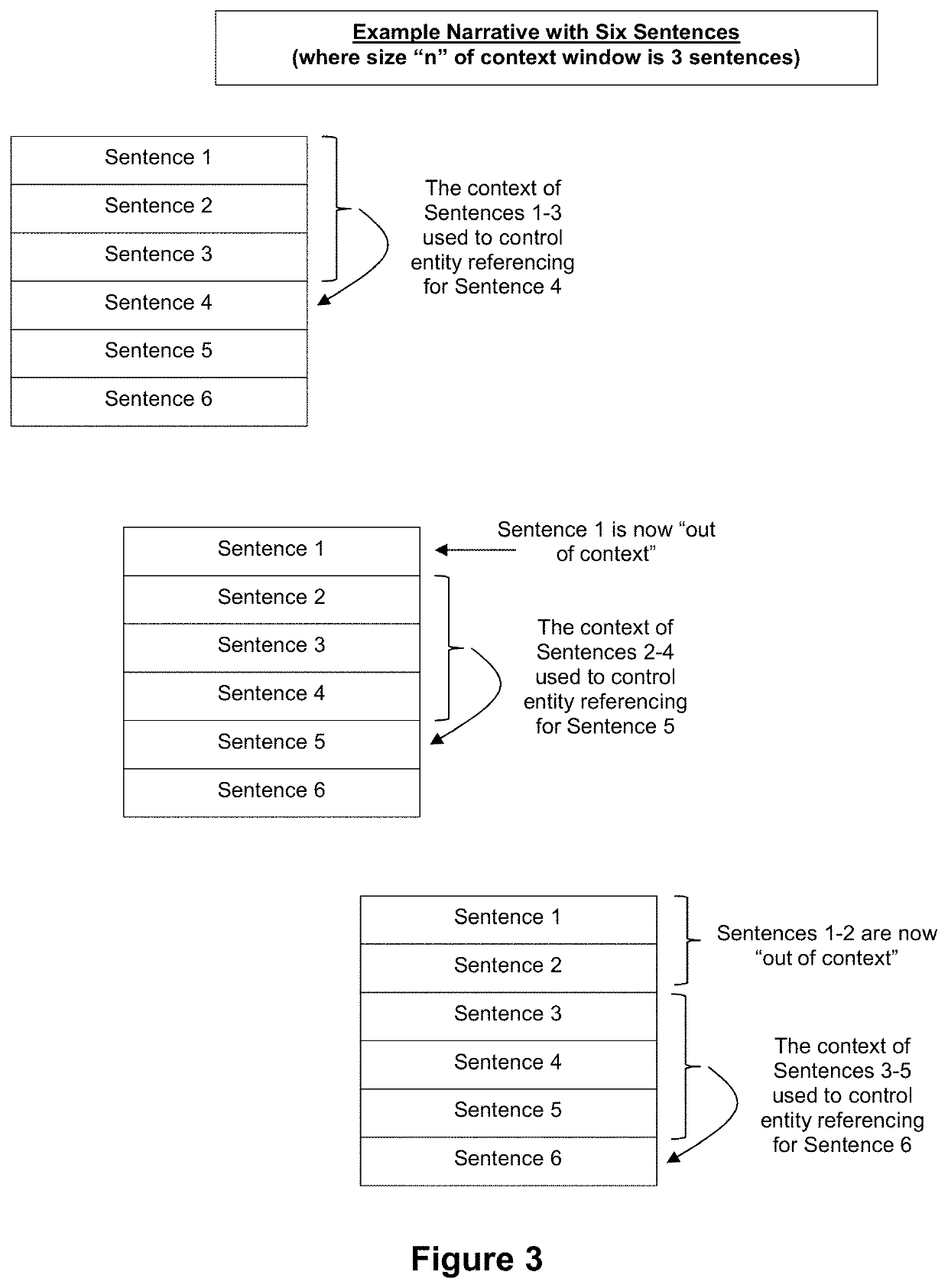

Context saliency-based deictic parser for natural language processing

Context Saliency-Based Deictic Parser for Natural Language Processing NLP techniques are disclosed that apply computer technology to sentence data for performing entity referencing. For example, a processor can parse sentence data in a defined window of sentence data into a list of entity terms and a plurality of classifications associated with the listed entity terms. A processor can also a plurality of context saliency scores for a plurality of the listed entity terms based on the classifications associated with the listed entity terms as well as maintain a list of referring terms corresponding to the listed entity terms. For new sentence data that includes a referring term from the referring term list, a processor can (i) select a corresponding entity term on the entity term list based on the context saliency scores for the entity terms, and (ii) infer that the referring term in the new sentence data refers to the selected corresponding entity term.

Owner:NARRATIVE SCI

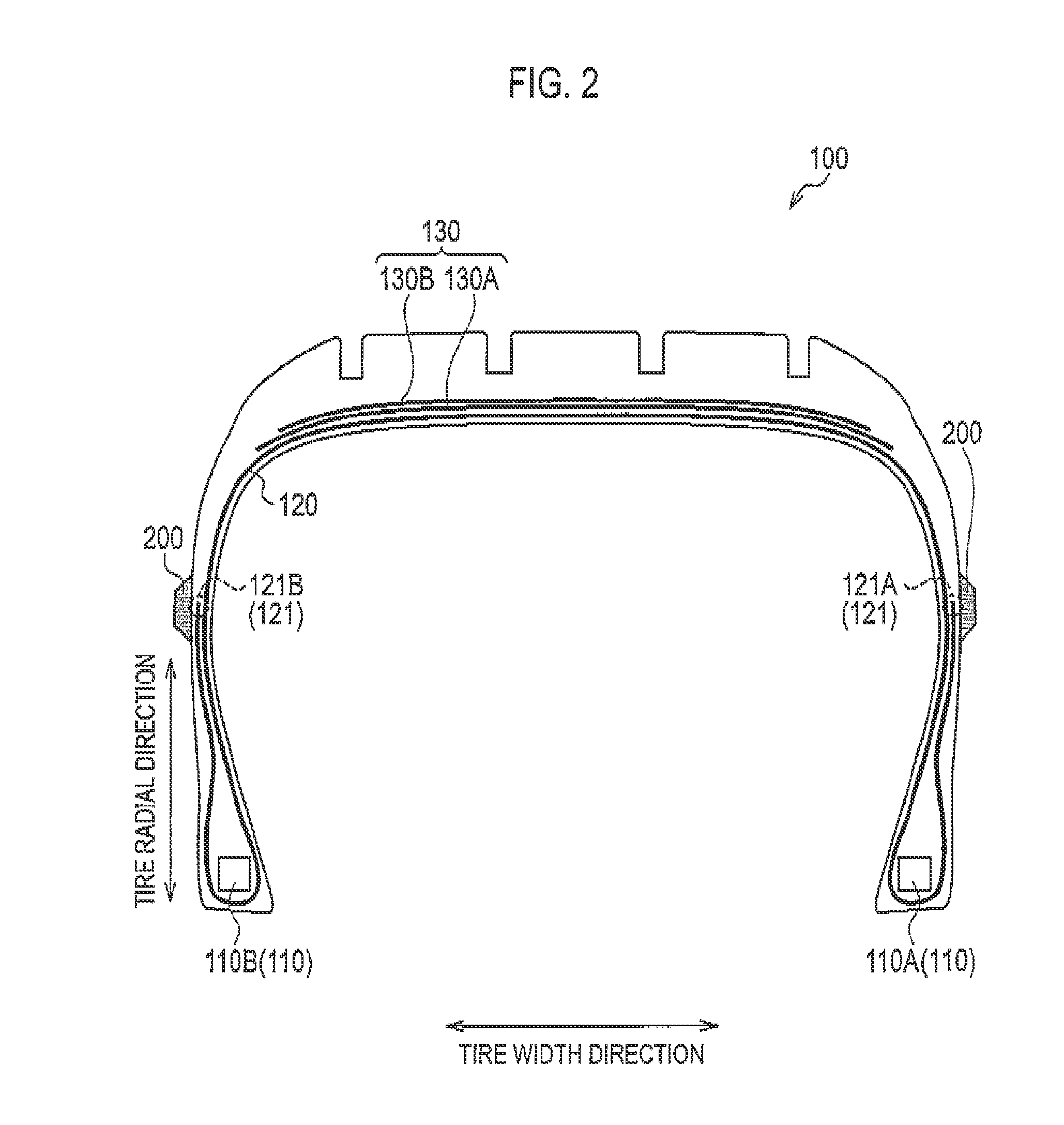

Pneumatic radial tire for use on passenger cars

ActiveUS20130048185A1Improve the immunityImprove steering stabilityPneumatic tyre reinforcementsYarnMechanical engineeringElastic modulus

A belt cover layer is provided on an outer circumferential side of a belt layer. The belt cover layer is constituted by a band-like member in which steel cords are embedded in rubber. Adjacent revolution portions of the band-like member are wound spirally in a tire circumferential direction so as not to contact each other in a region of at least 50% of a belt width centered on a tire equator. A load-strain curve of the steel cords has an inflection point in a strain region of 1% to 3.5%. An average elastic modulus when the steel cords are subjected to a load from 50 N to 100 N is from 25 GPa to 100 GPa.

Owner:YOKOHAMA RUBBER CO LTD

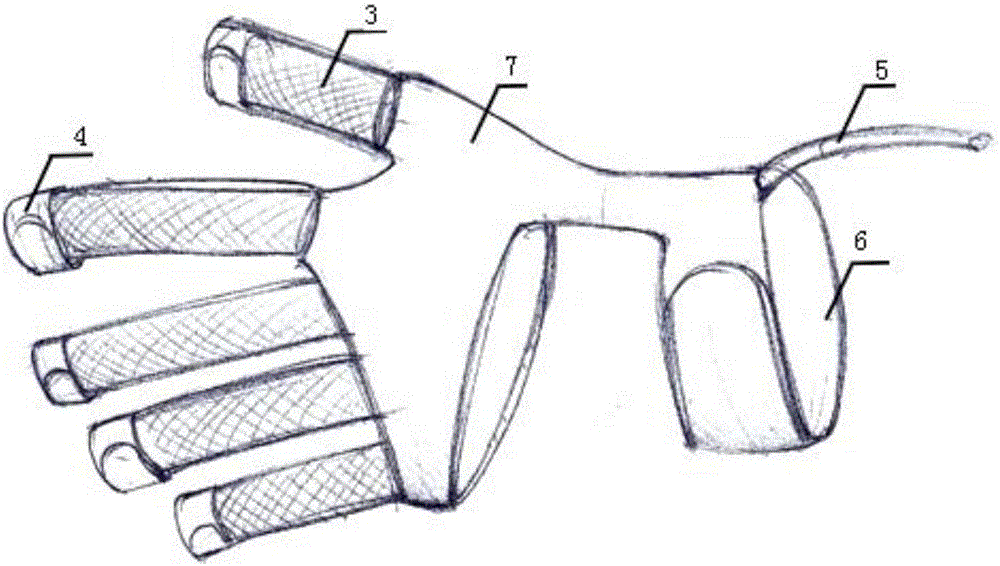

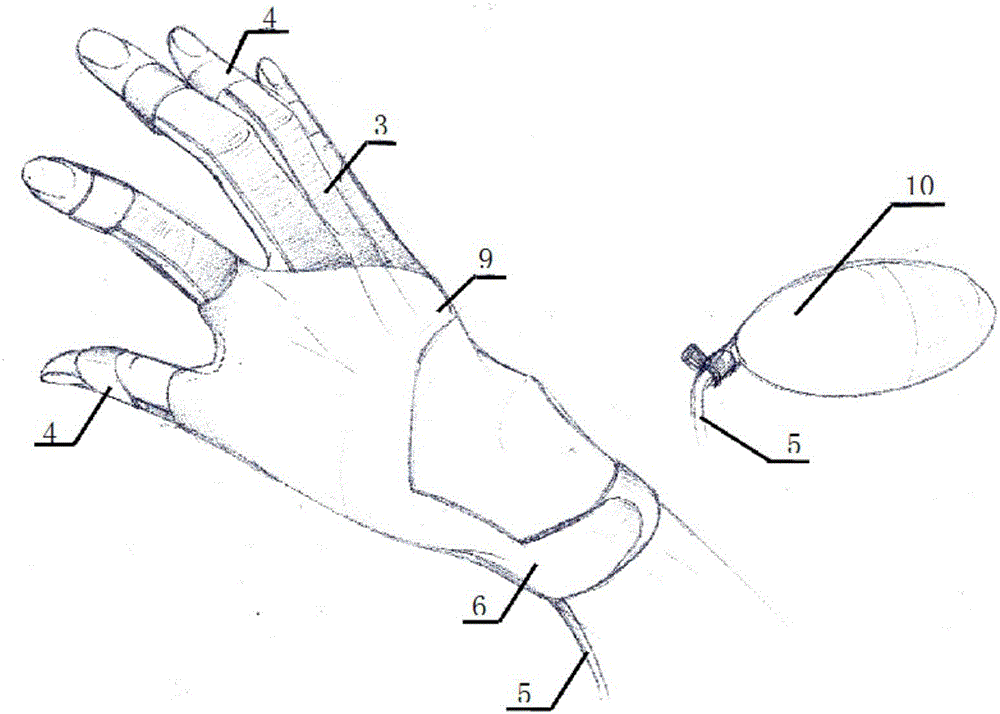

Flexible rehabilitation training glove for stroke patients

The invention discloses a flexible rehabilitation training glove for stroke patients, which comprises a flexible retractable finger traction component and a driving component, and there are five flexible retractable finger traction components arranged in a hand shape. All flexible retractable finger traction components are connected with the driving component, and are stretched under the drive of the driving component; all flexible retractable finger traction components are provided with finger band and / or finger stall. According to the flexible rehabilitation training glove, stroke patients can carry out rehabilitation training for hands, stimulate the reestablishment of neural pathways, prevent the adhesion of soft tissue, prevent muscle atrophy, and avoid the ossification of hand tissue due to calcification, so as to promote the rehabilitation of stroke.

Owner:EDINBURGH NANJING OPTO ELECTRONICS EQUIP CO LTD

Context saliency-based deictic parser for natural language generation

NLG techniques are disclosed that apply computer technology to sentence data for performing entity referencing. For example, a processor can parse sentence data in a defined window of sentence data into a list of entity terms and a plurality of classifications associated with the listed entity terms. A processor can also compute a plurality of context saliency scores for a plurality of the listed entity terms based on the classifications associated with the listed entity terms. For new sentence data that refers to an entity term from the entity term list, a processor can select a referring term for referencing that entity term from a list of candidate referring terms based on the context saliency scores for the entity terms. A processor can then form the new sentence data such that the new sentence data includes the selected referring term to refer to the at least one entity term.

Owner:NARRATIVE SCI

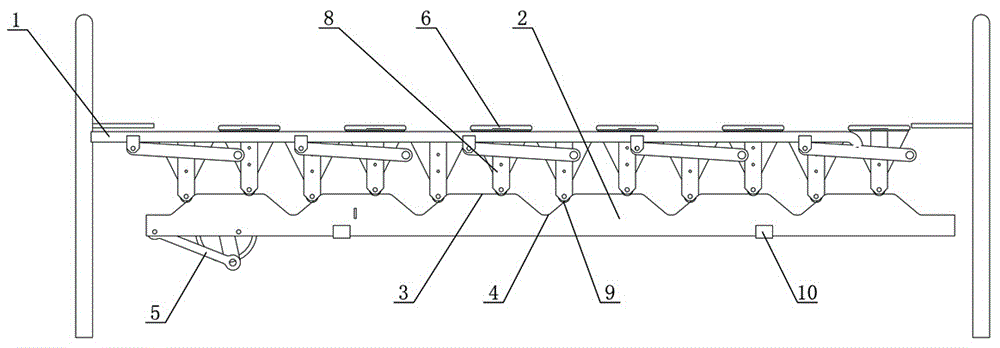

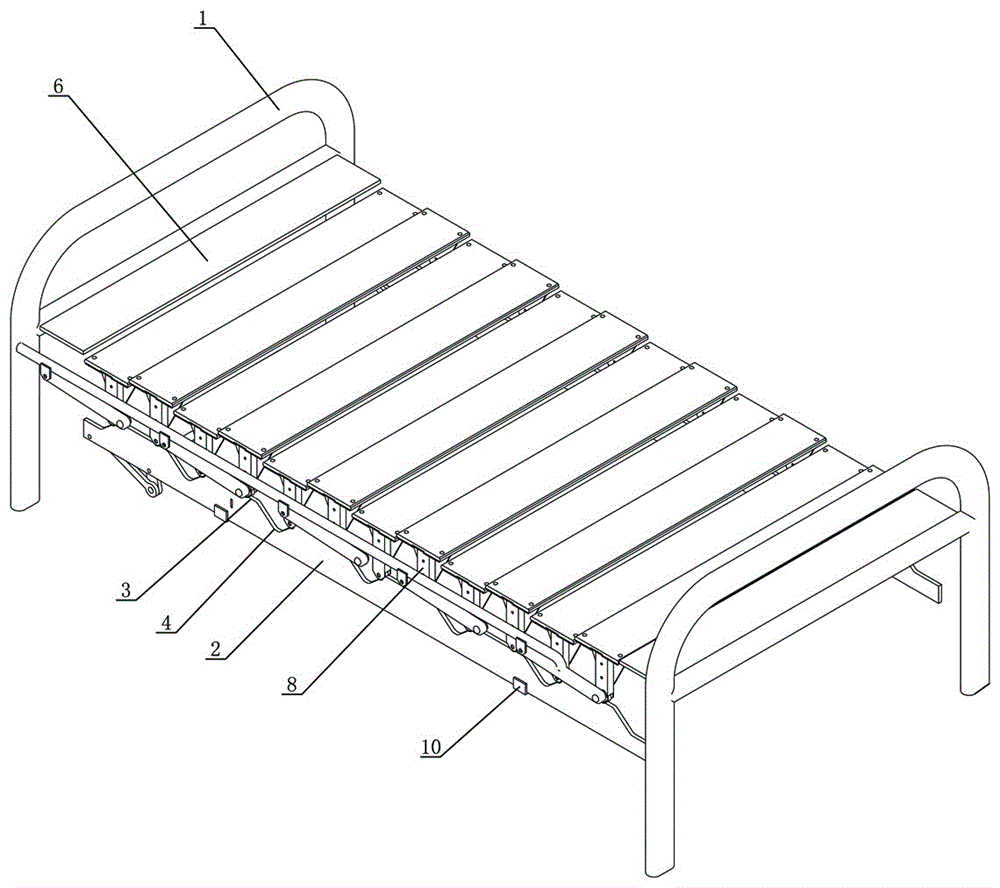

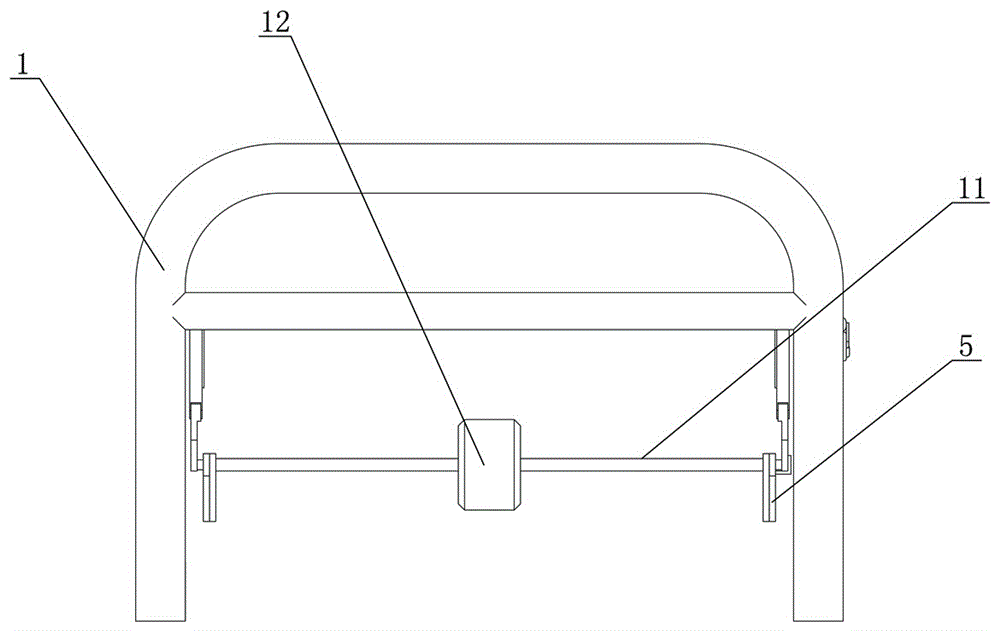

Translation bed

ActiveCN105877942ARelieve stressGuarantee unimpededChiropractic devicesNursing bedsHuman bodyReciprocating motion

The invention provides a translation bed, which comprises a bed body and a bed plate, wherein a rail is arranged at one side of the bed body; the rail comprises a horizontal rail segment and an arc groove segment, which are arranged at an interval; the rail carries out horizontal reciprocating motion in the direction from a bed head to a bed tail under the drive of a power mechanism; the bed body is provided with a main horizontal slideway for supporting the rail for motion; the bed plate comprises a plurality of strip plates which are arranged at equal intervals and are transversely arranged on the bed body; a push rod is arranged at one end, corresponding to the rail, of each strip plate; a vertical guide slideway is arranged on the bed body; a pulley is arranged at the lower end of each push rod; and the strip plates carry out reciprocating motion in the vertical direction under the drive of the rail. By the translation bed, the pressure on blood vessels of a human body in a long-term lying state is relieved by alternate support of the strip plates; smooth blood is kept; the vitality of muscle of a patient lying in bed for a long period of time is improved; and the diseases of bedsores and the like are avoided.

Owner:河南铭哲能源科技有限公司

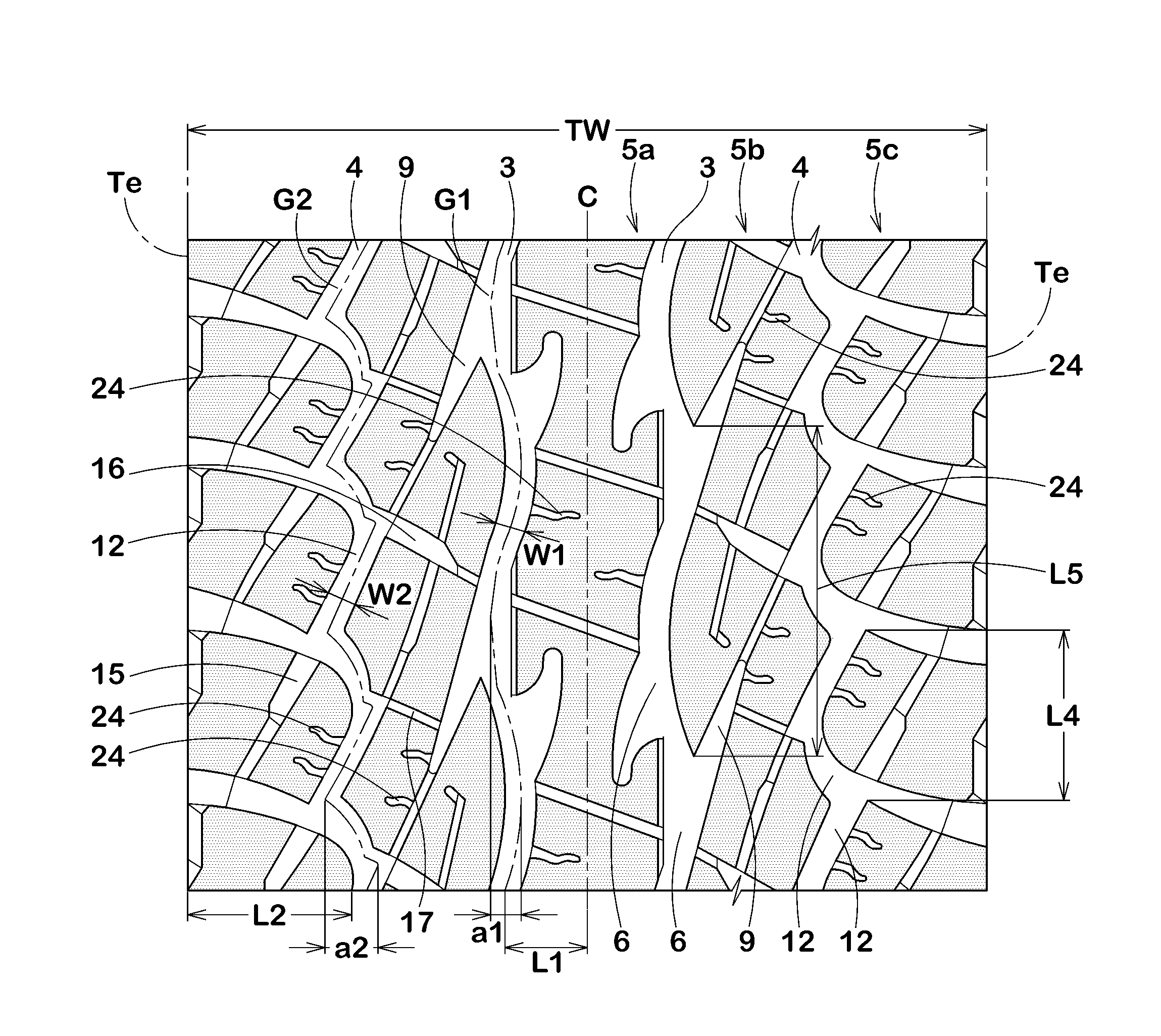

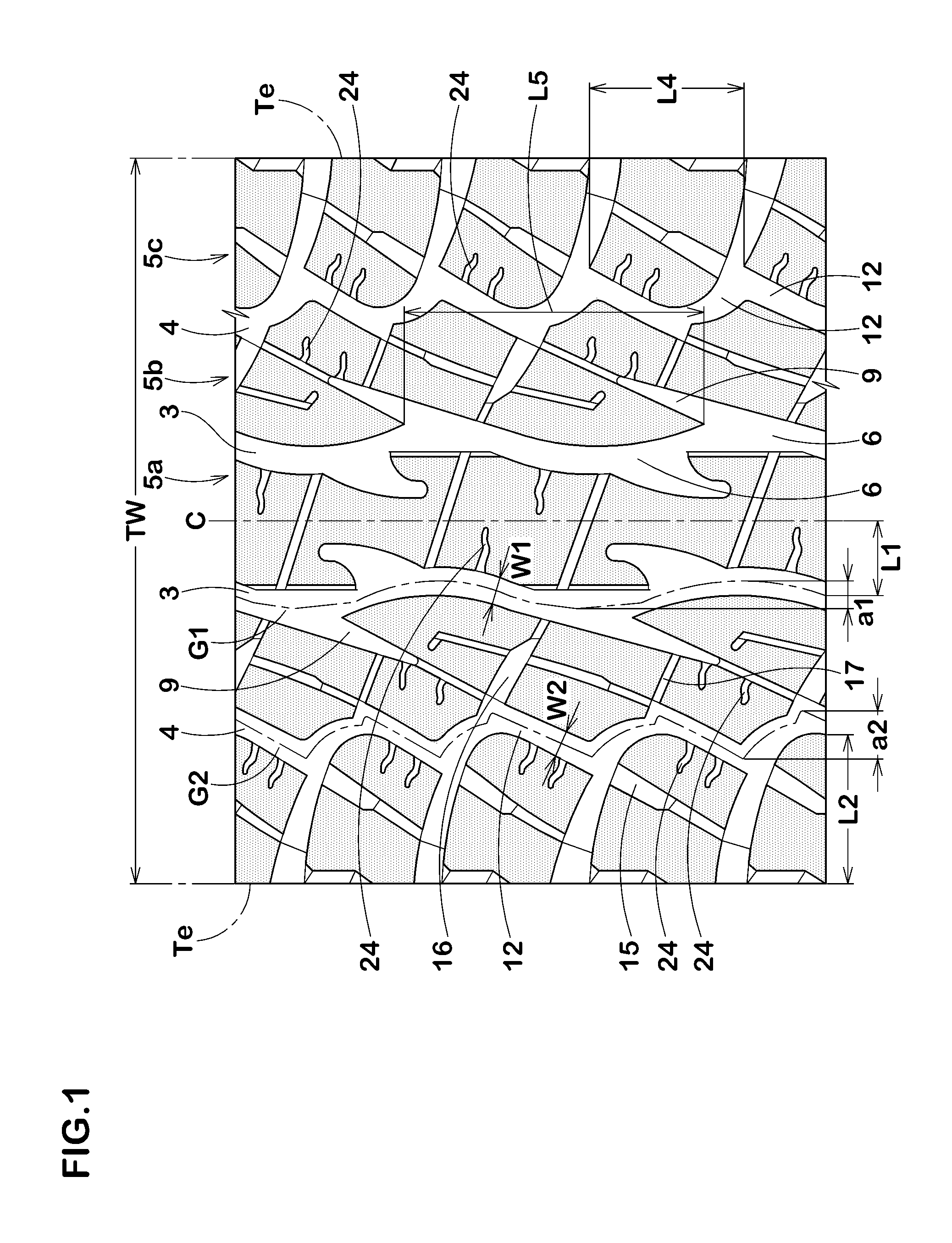

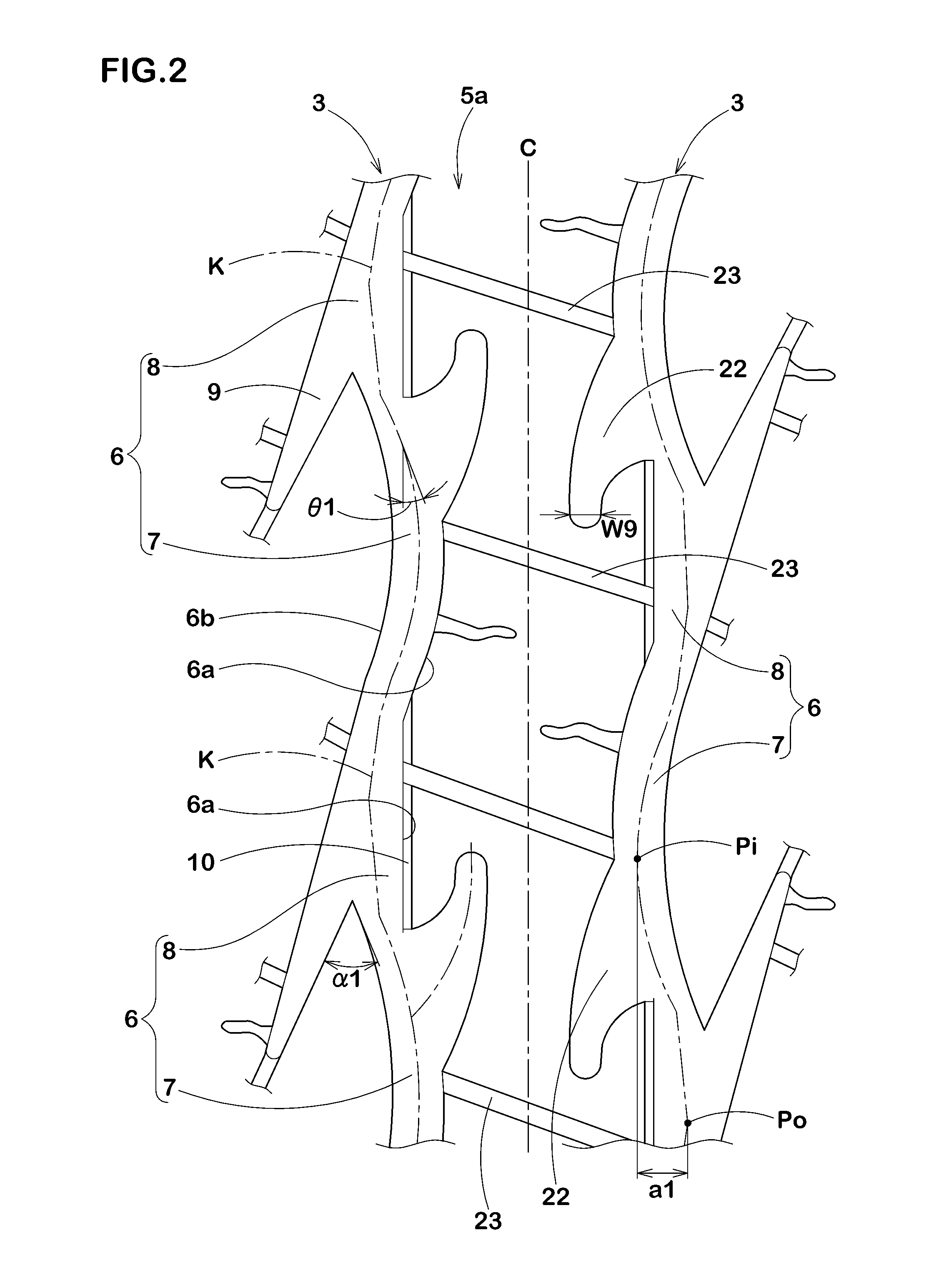

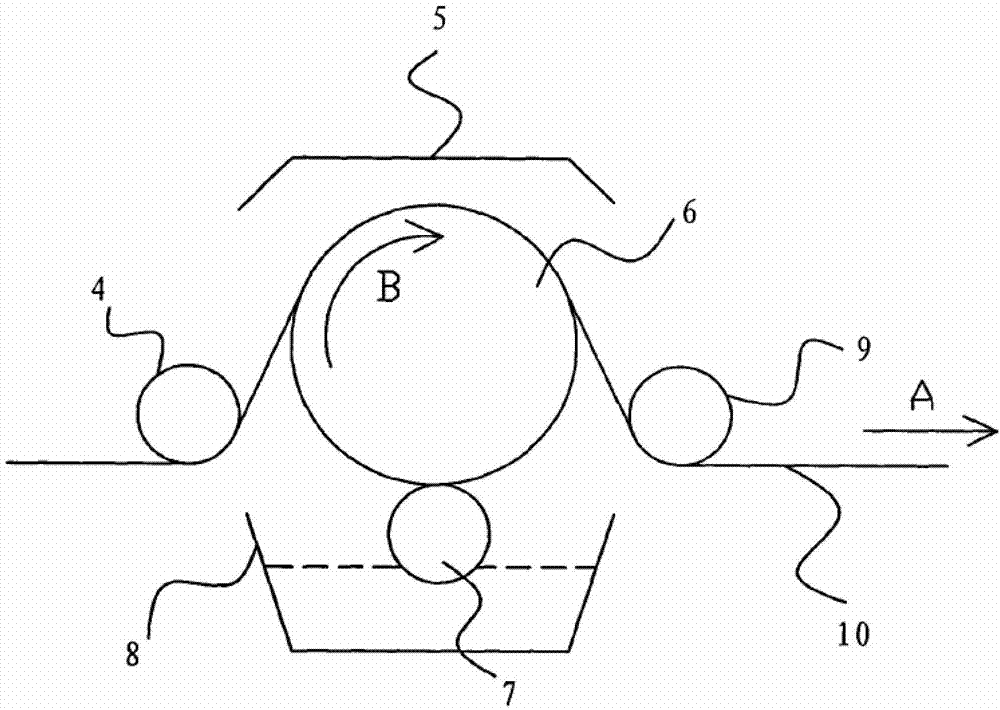

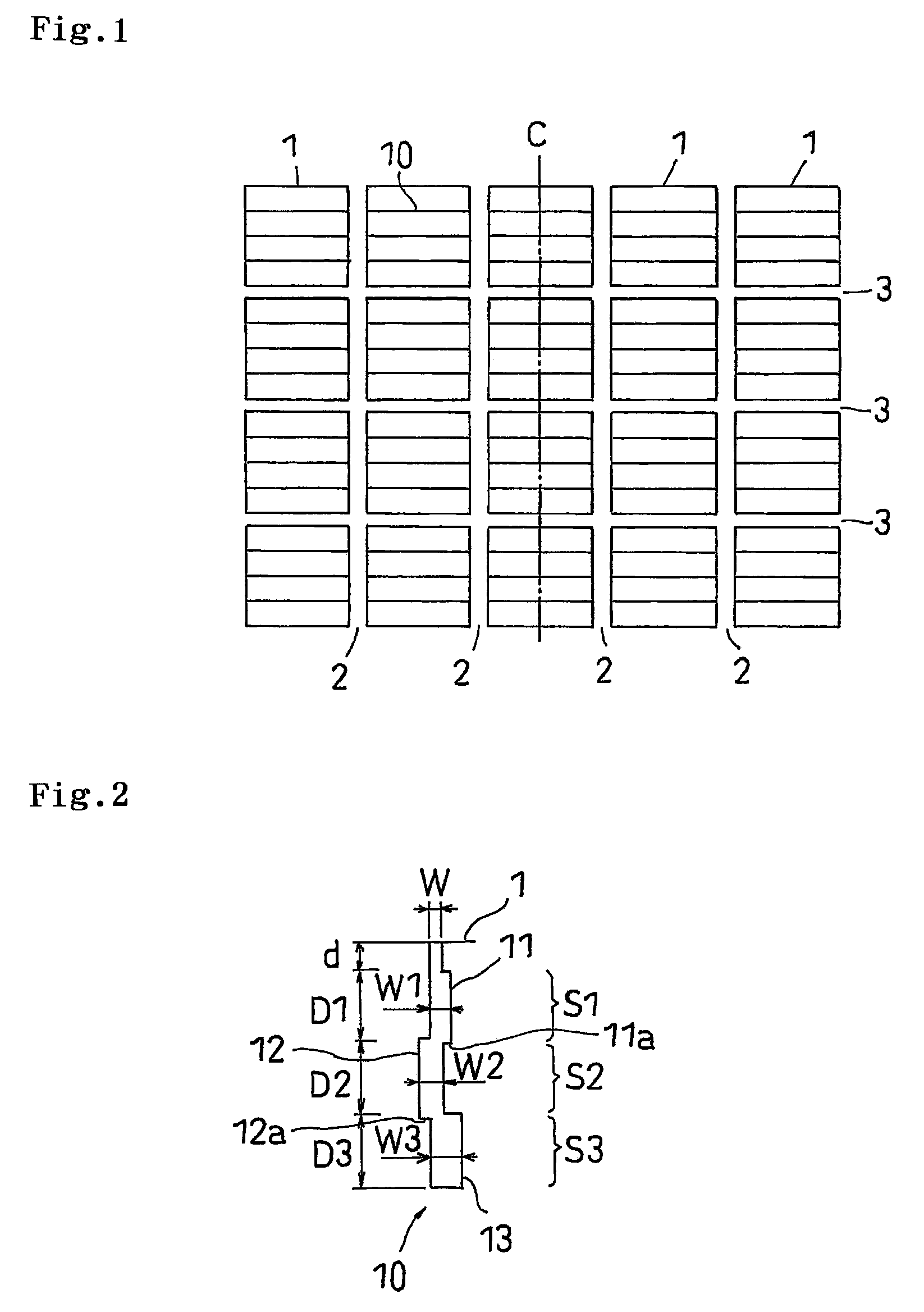

Pneumatic tire

InactiveUS20120111466A1Improve drainage capacityMaintaining uneven wear resistanceTyre tread bands/patternsNon-skid devicesEngineering

In a pneumatic tire 1, a center land portion 5a between center main grooves 3, a middle land portion 5b between the center main groove 3 and a shoulder main groove 4, and a pair of shoulder land portions 5c extending on outer sides of the shoulder main groove 4 in a tire axial direction are divided from each other. The center main groove 3 includes arc groove pieces 6 which are continuously provided in a tire circumferential direction. The arc groove piece 6 includes an arc portion 7 which is curved to swell toward a tire equator C. The middle land portion 5b is provided with a middle inclined groove 9 which extends from an intersection portion K of the arc groove piece 6 toward the shoulder main groove 4.

Owner:SUMITOMO RUBBER IND LTD

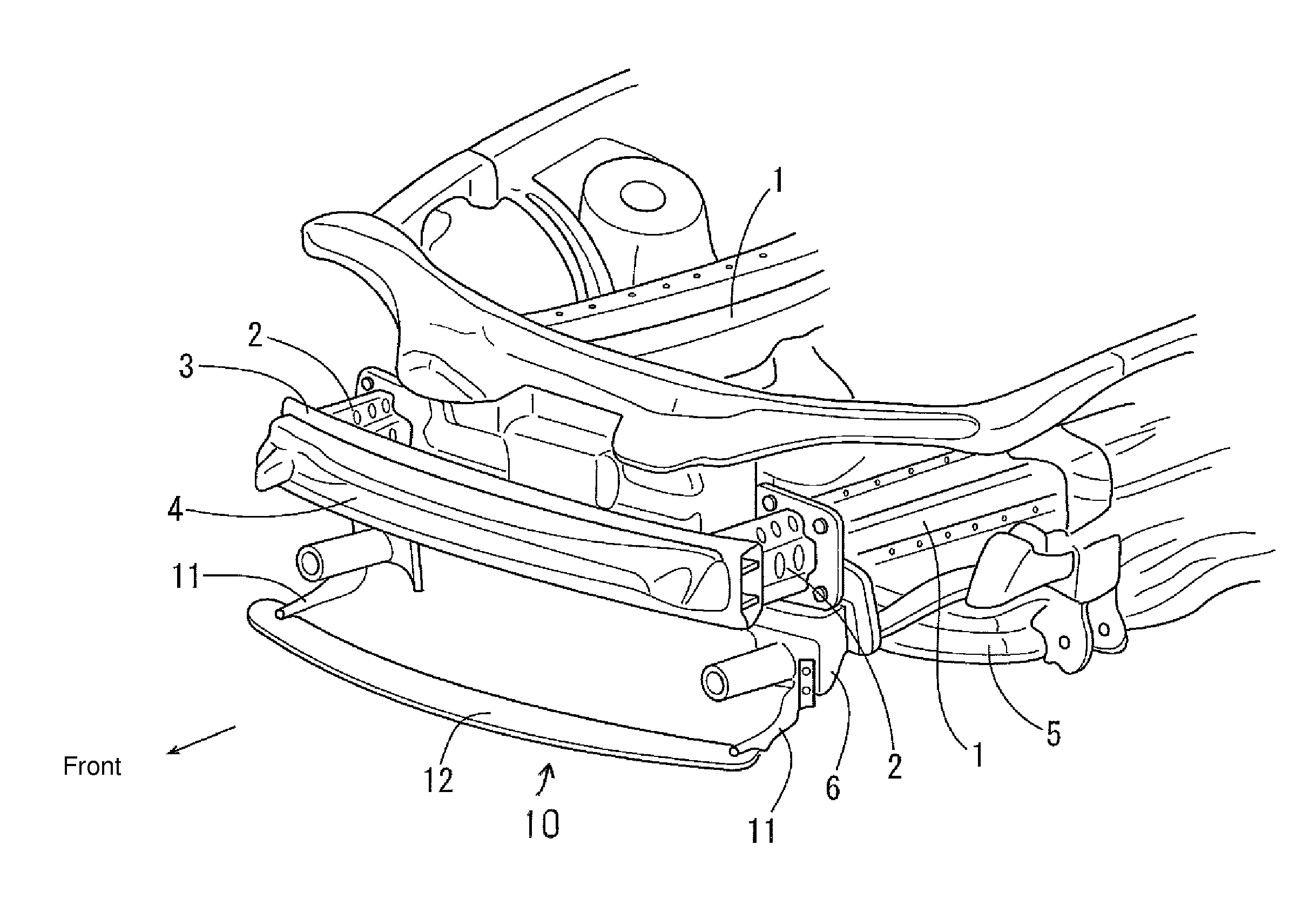

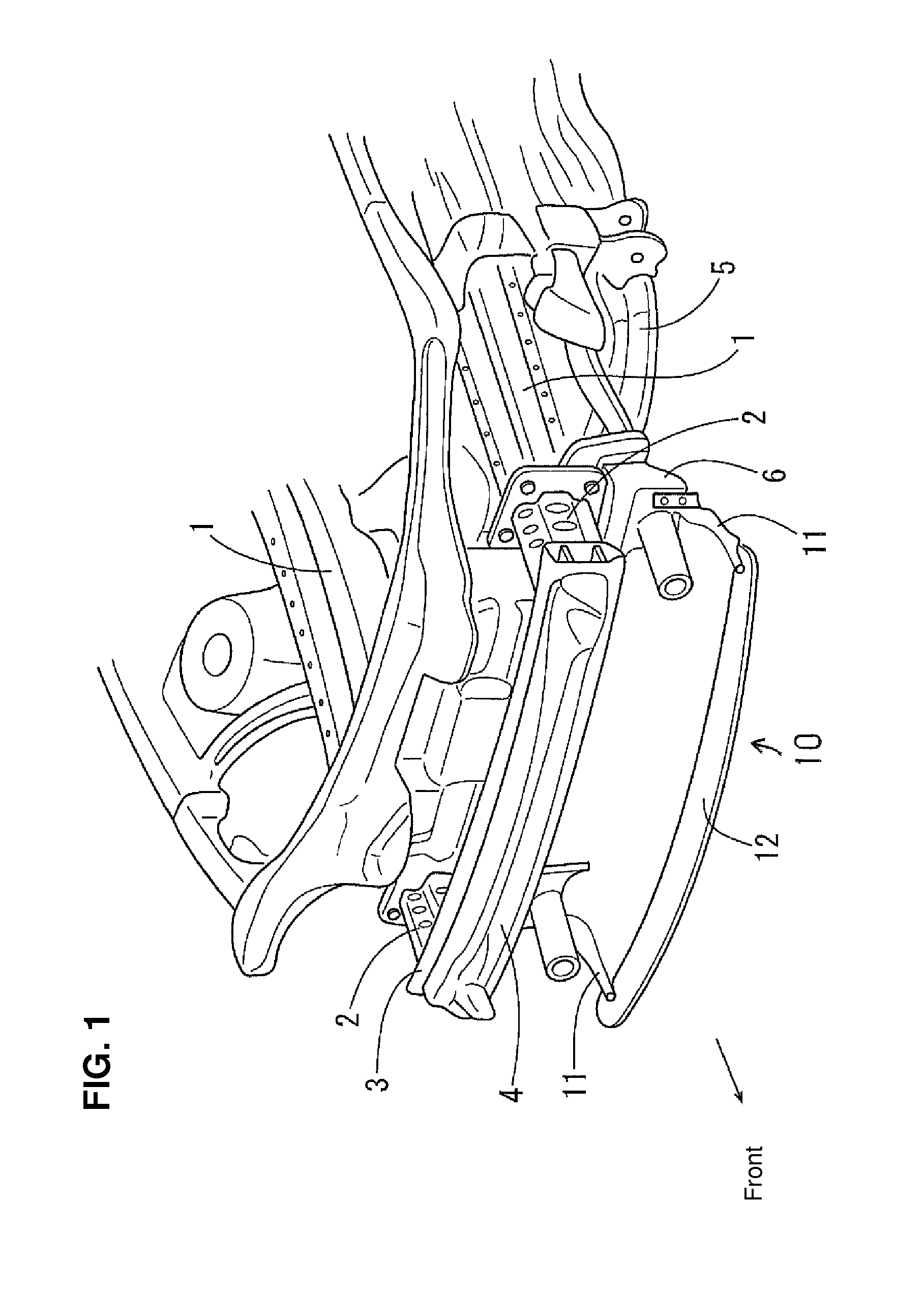

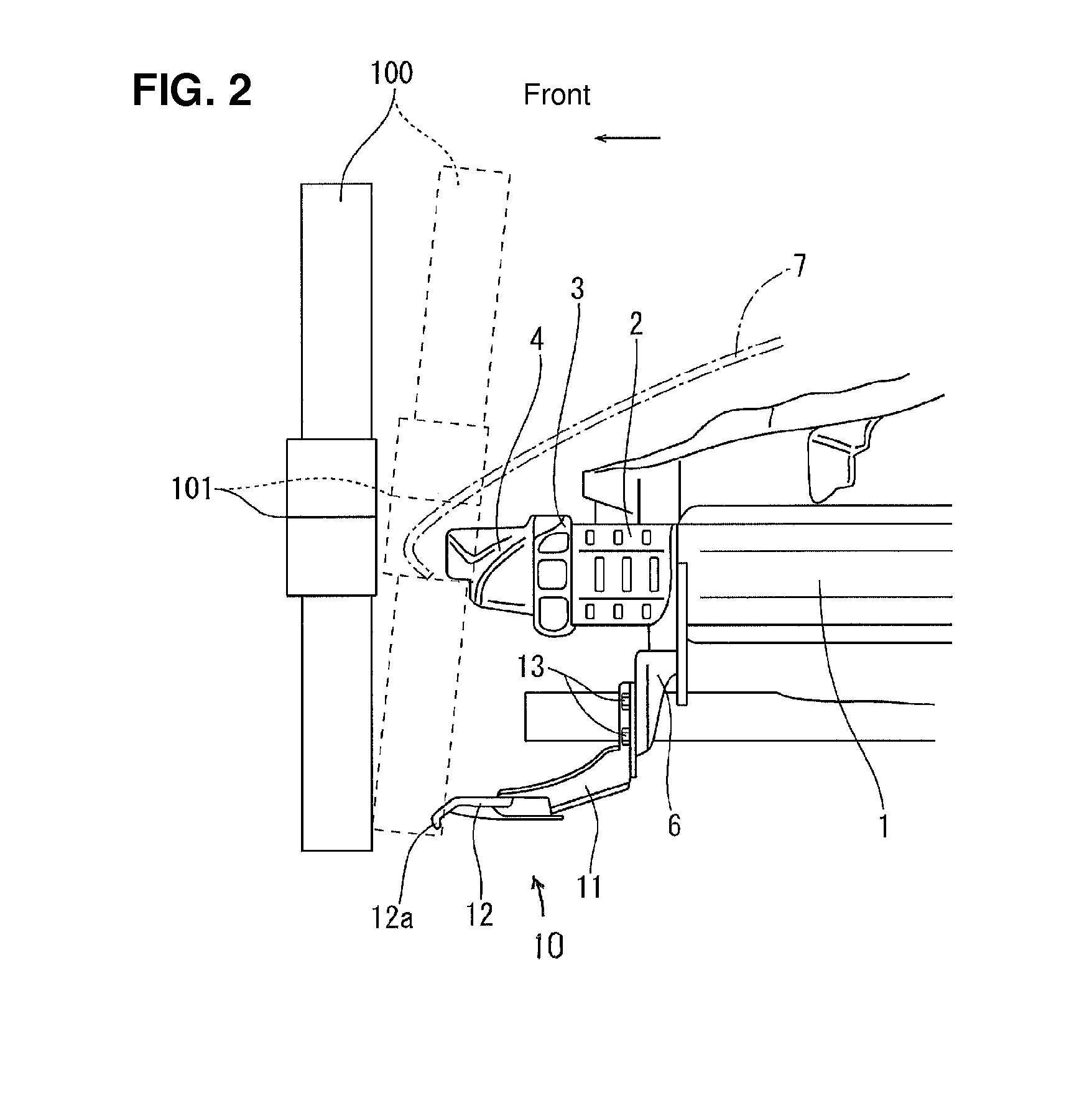

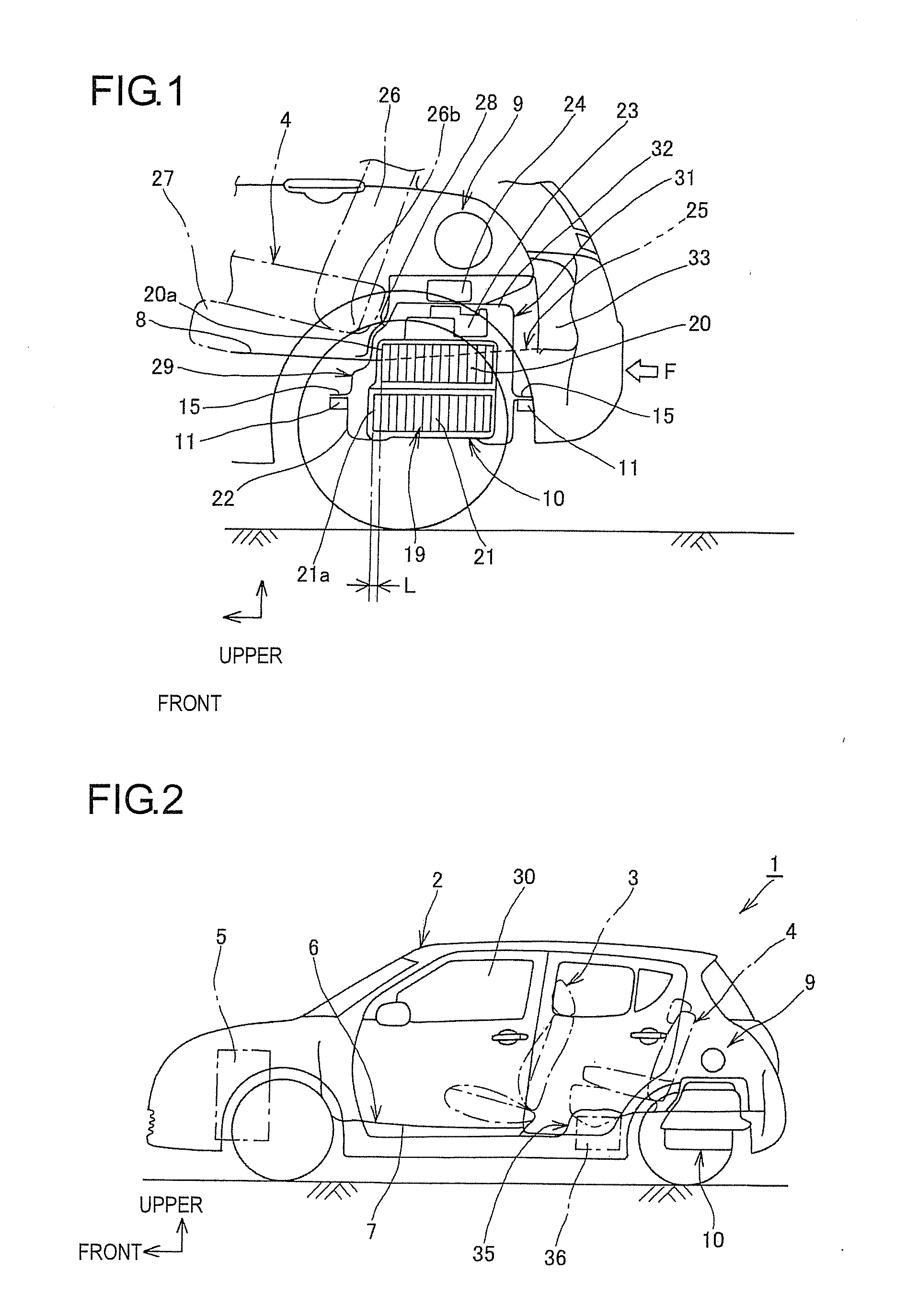

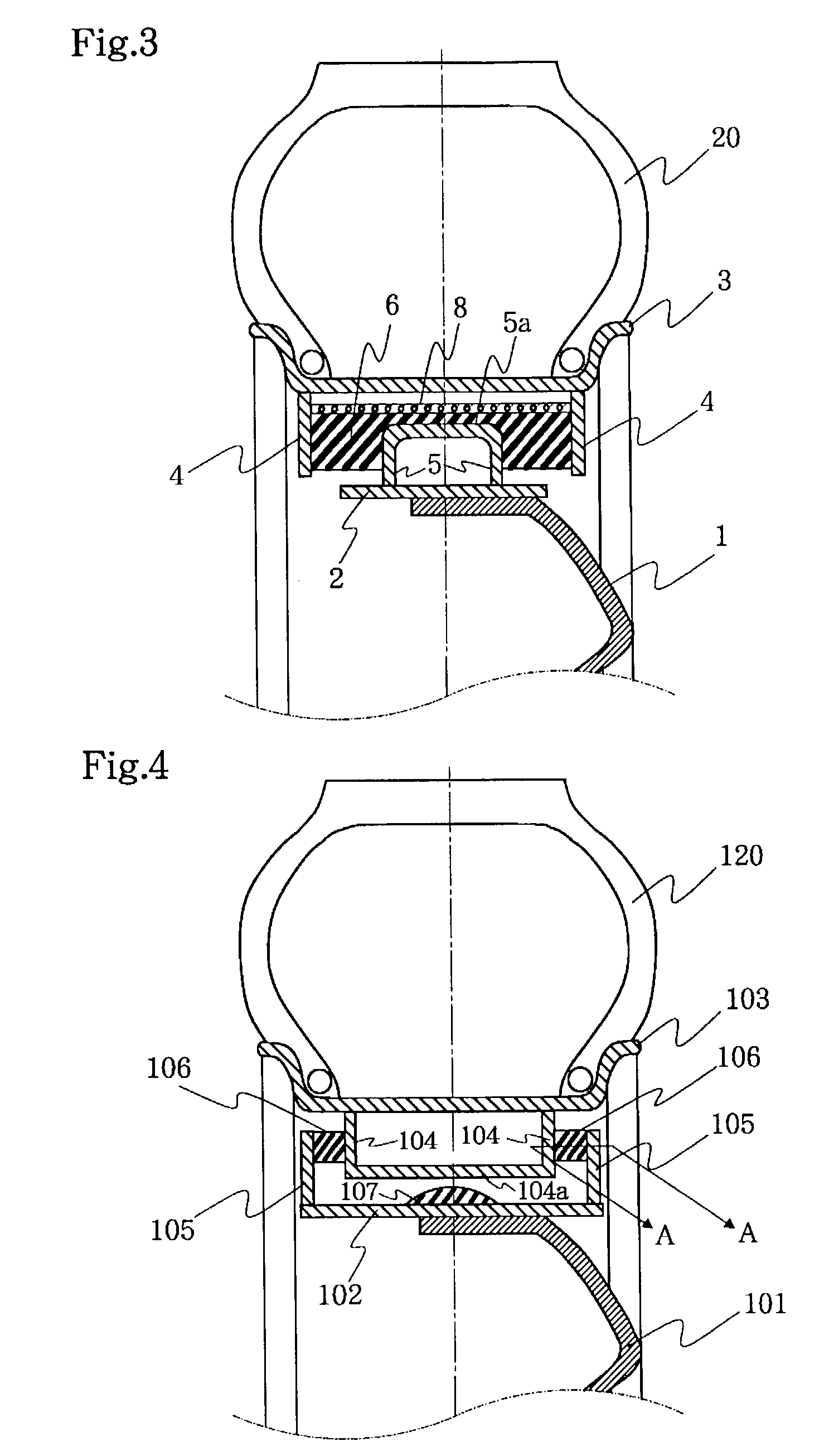

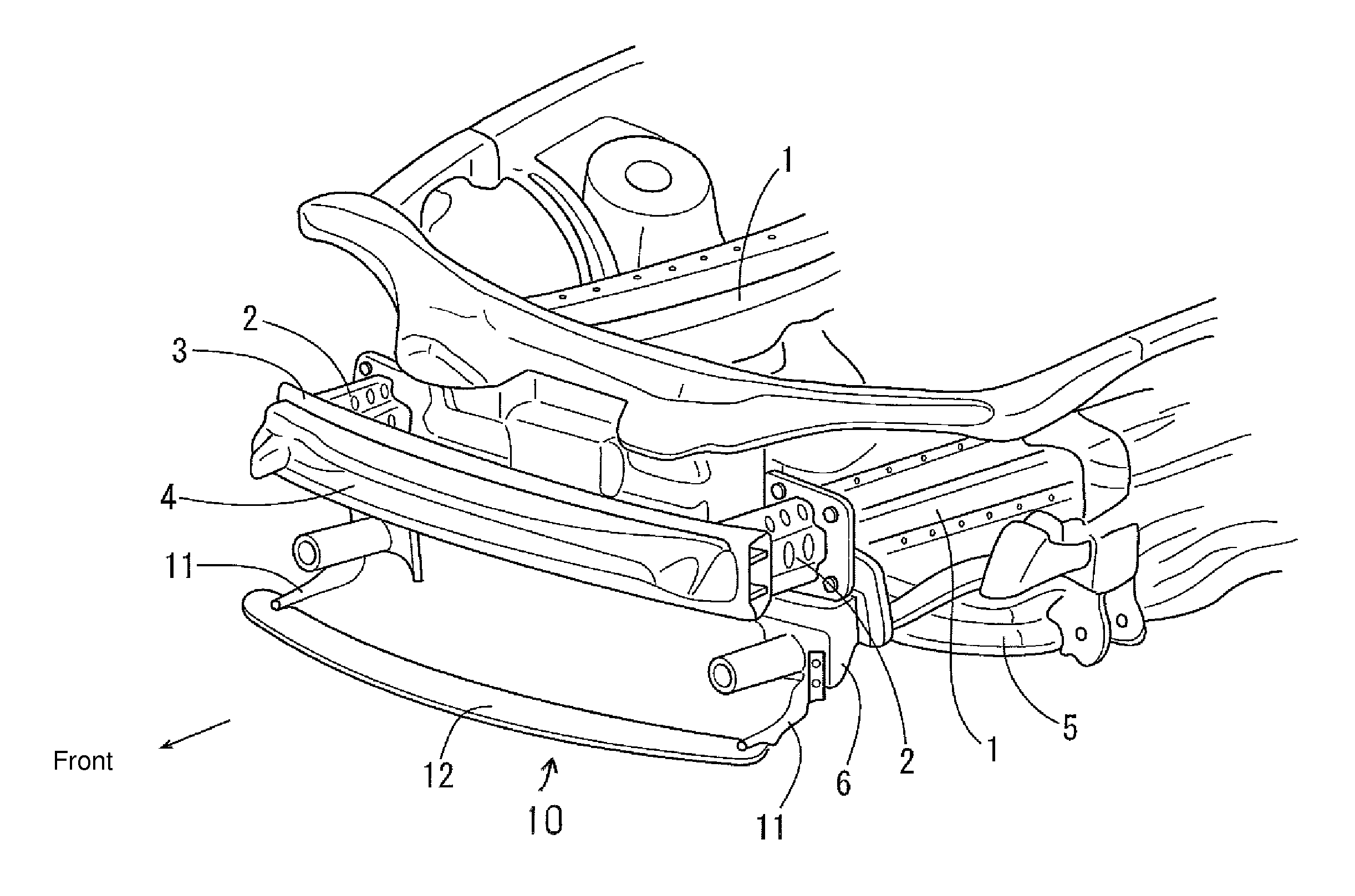

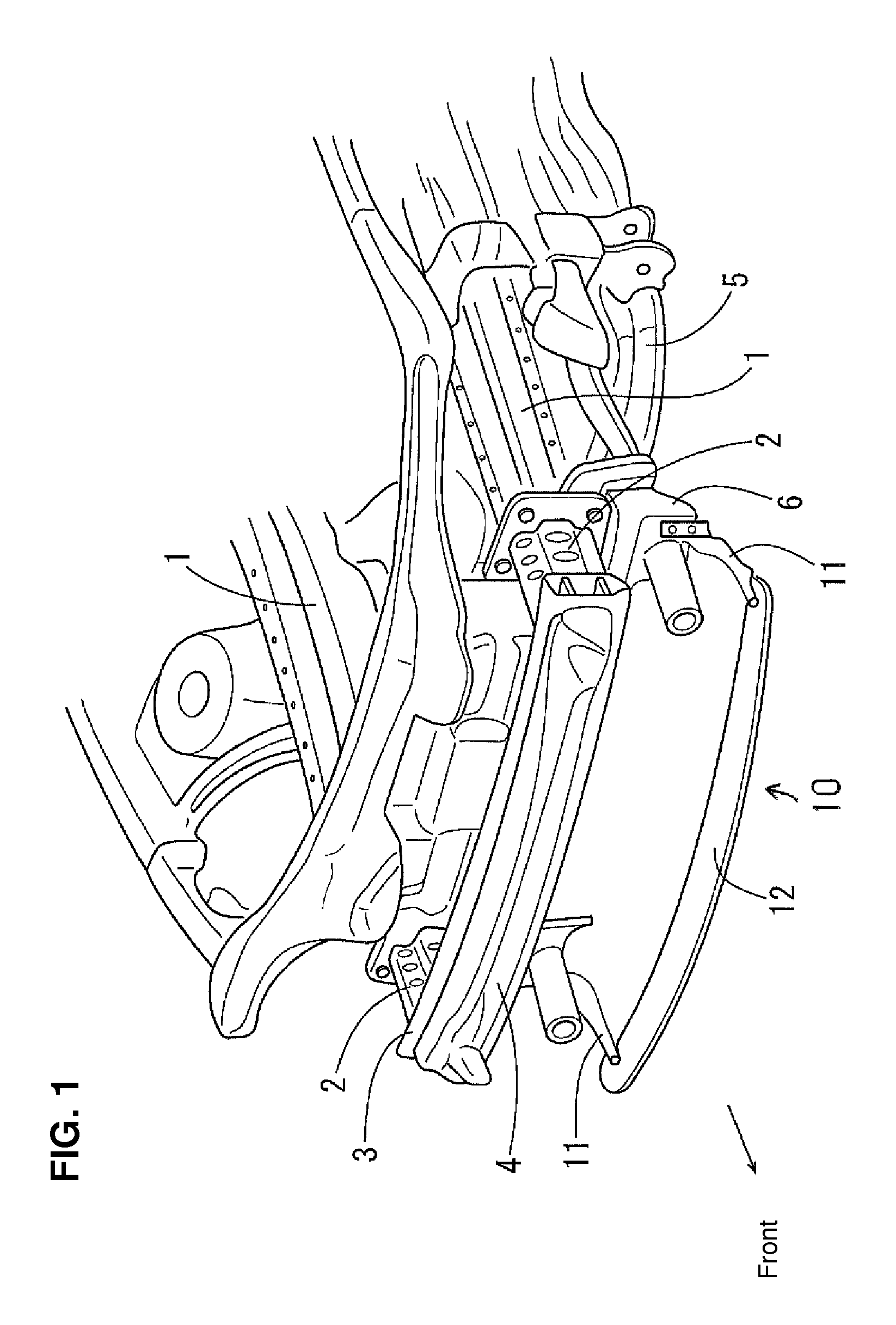

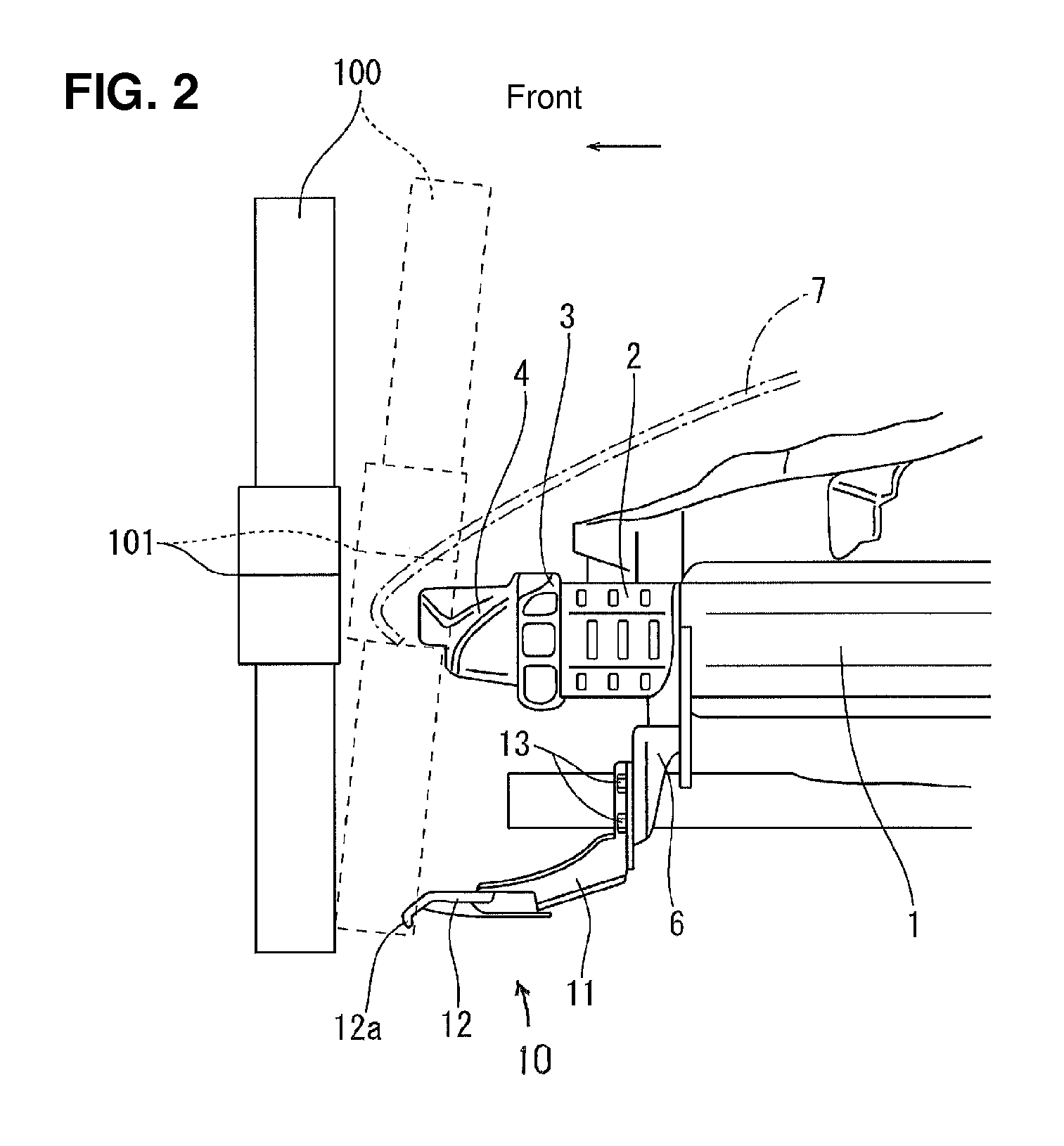

Vehicle-body front structure of vehicle

ActiveUS20150054306A1Sufficient energy absorptionSufficient energyVehicle seatsPedestrian/occupant safety arrangementEnergy absorptionEngineering

A pair of right-and-left brackets which extend obliquely downward and forward from respective front portions of a pair of right-and-left side frames are provided. A stiffener which extends in a vehicle width direction below a bumper beam is attached to respective front ends of the pair of right-and-left brackets. The stiffener is configured such that its front end portion slants downward and forward and has an open cross section, and its rear end portion thereof has a closed cross section. An obstacle can be prevented from coming in below a vehicle-body front portion, and also the sufficient energy absorption in a collision and the prompt flicking-up of an obstacle can properly achieved.

Owner:MAZDA MOTOR CORP

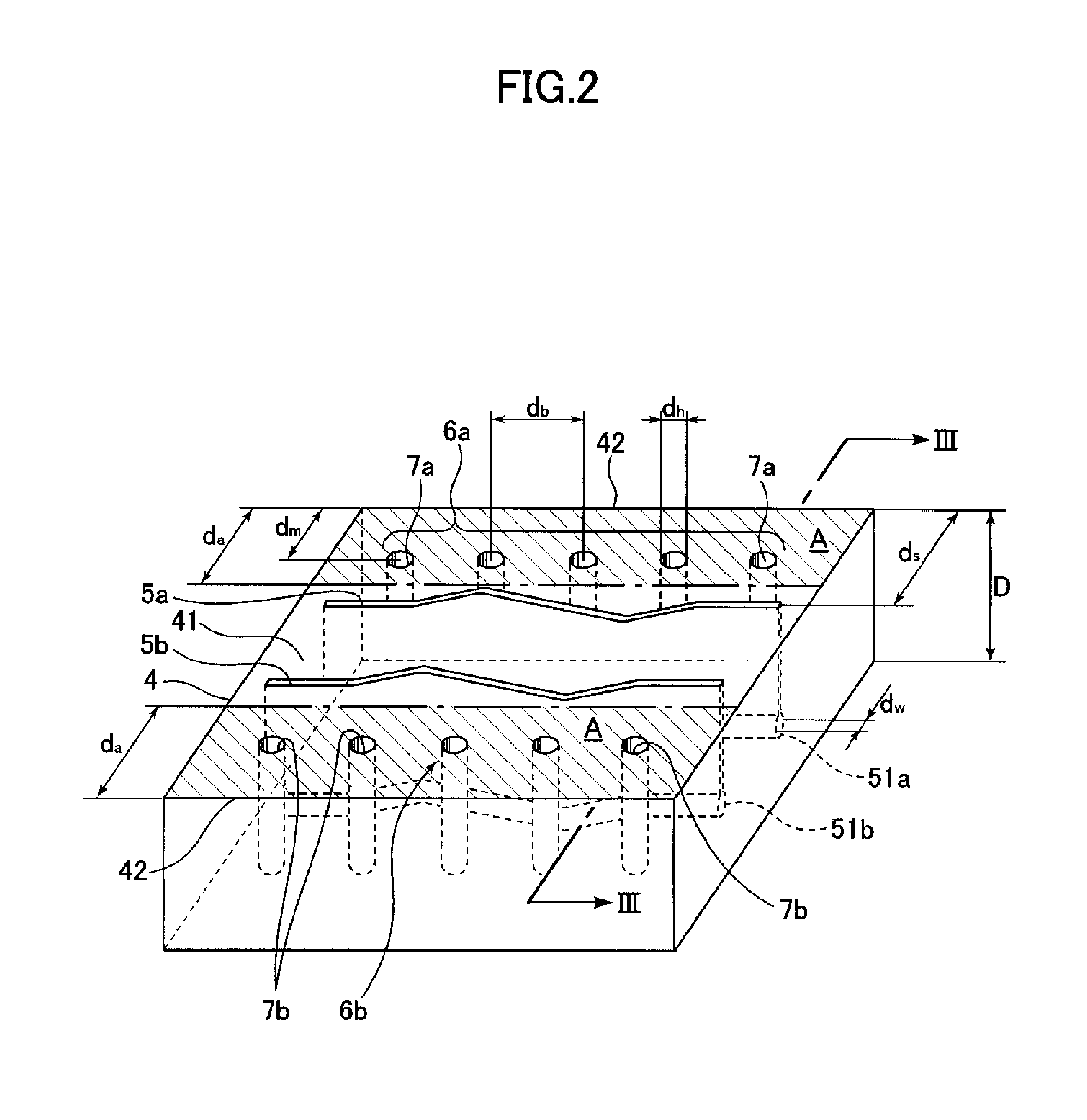

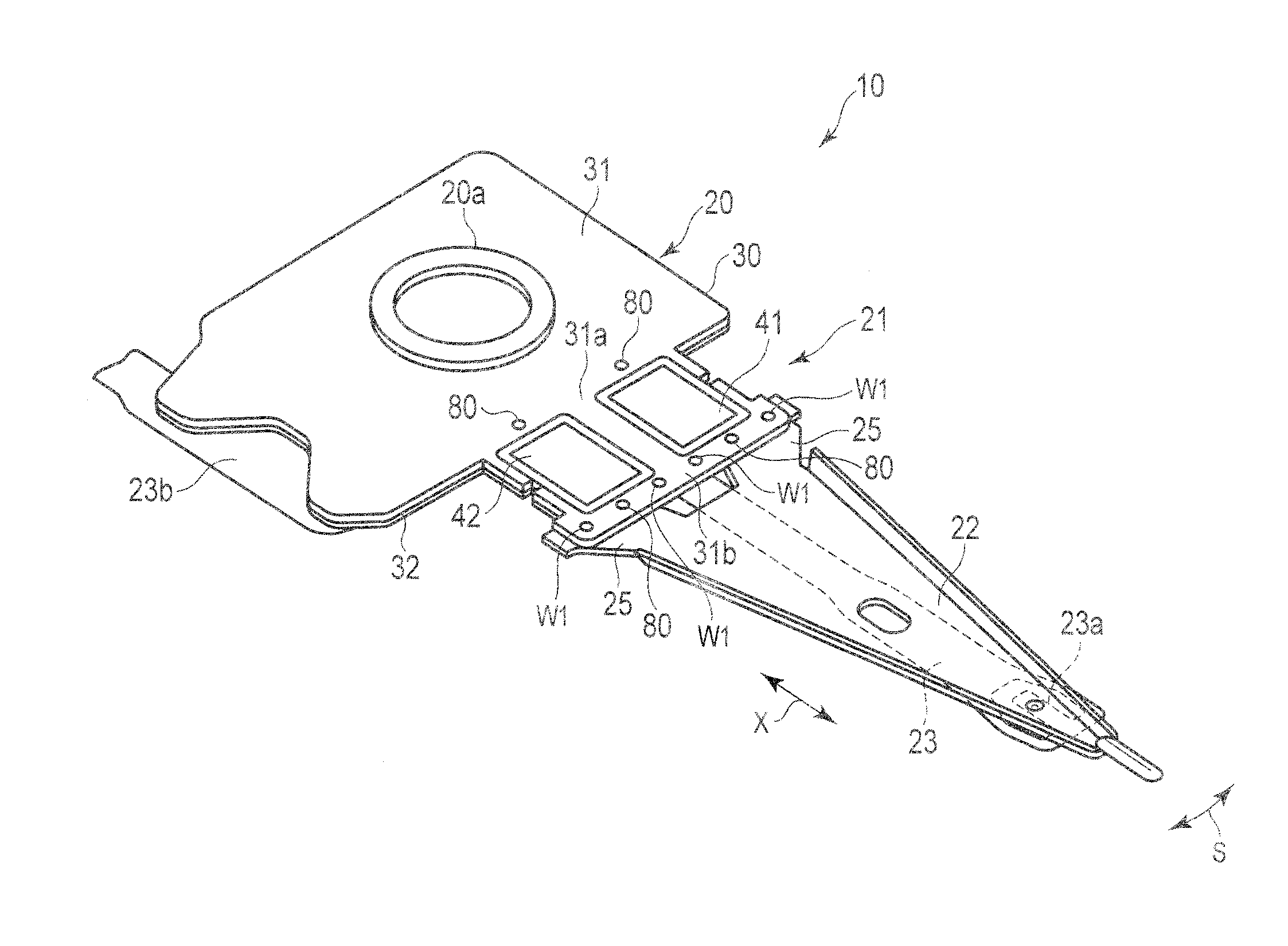

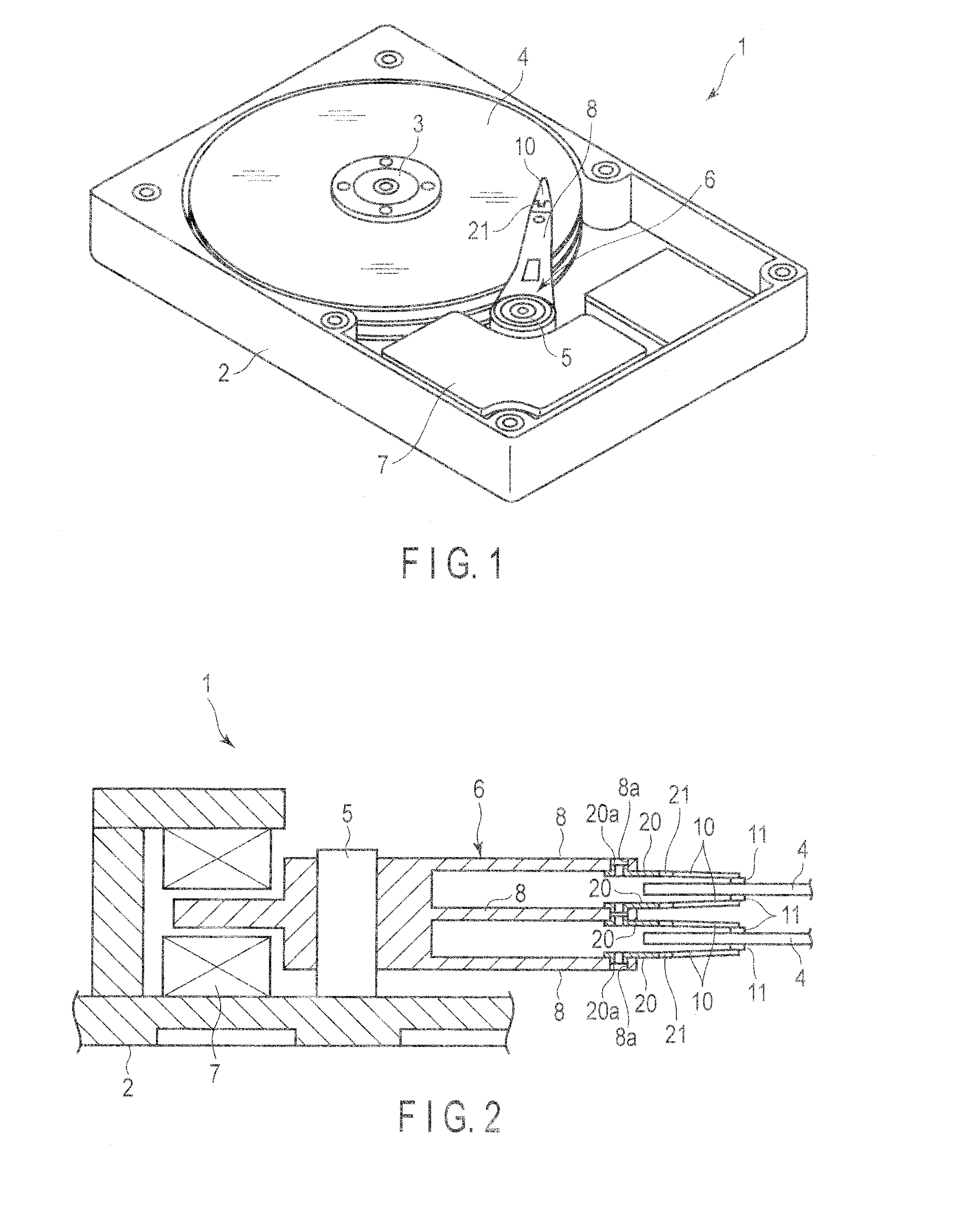

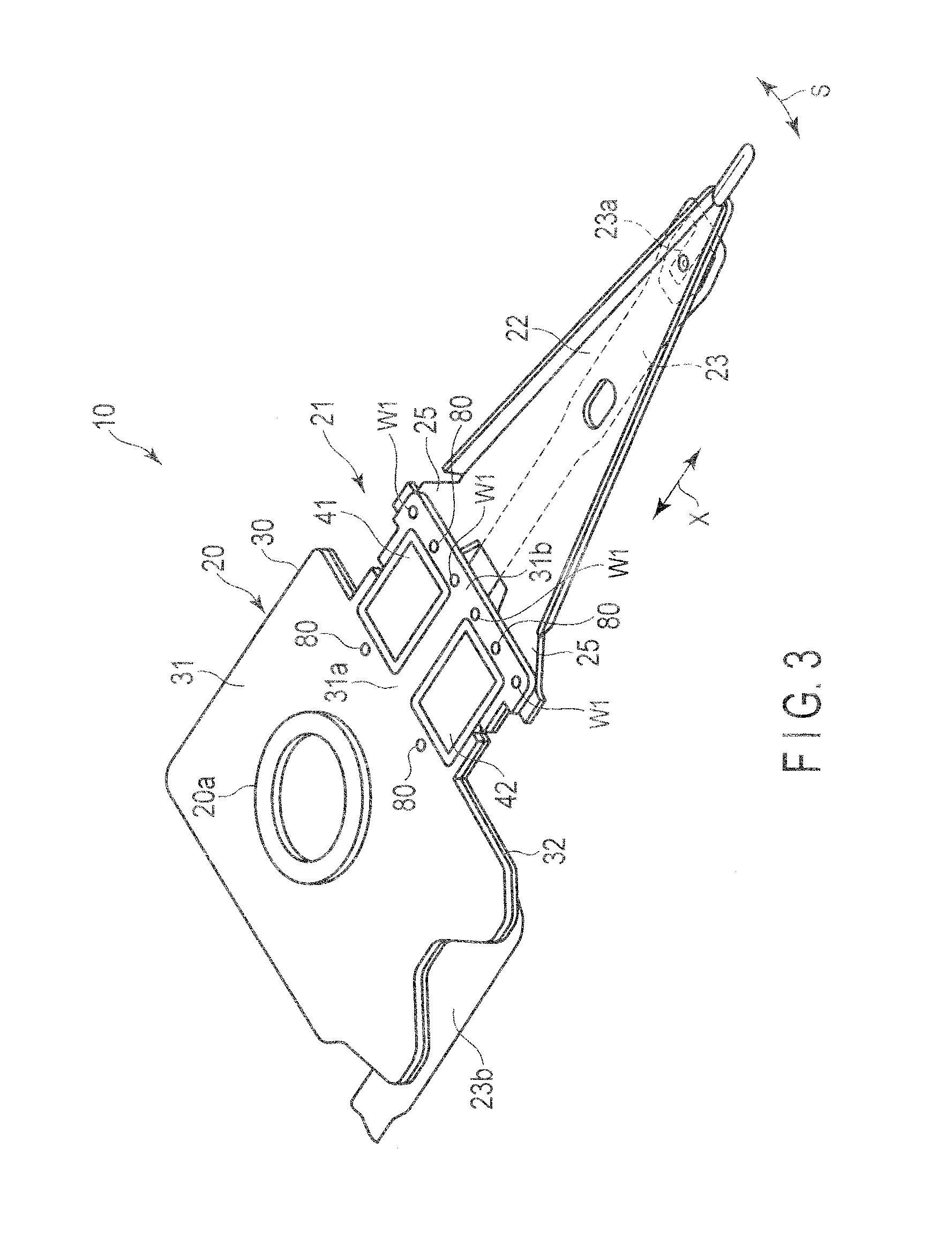

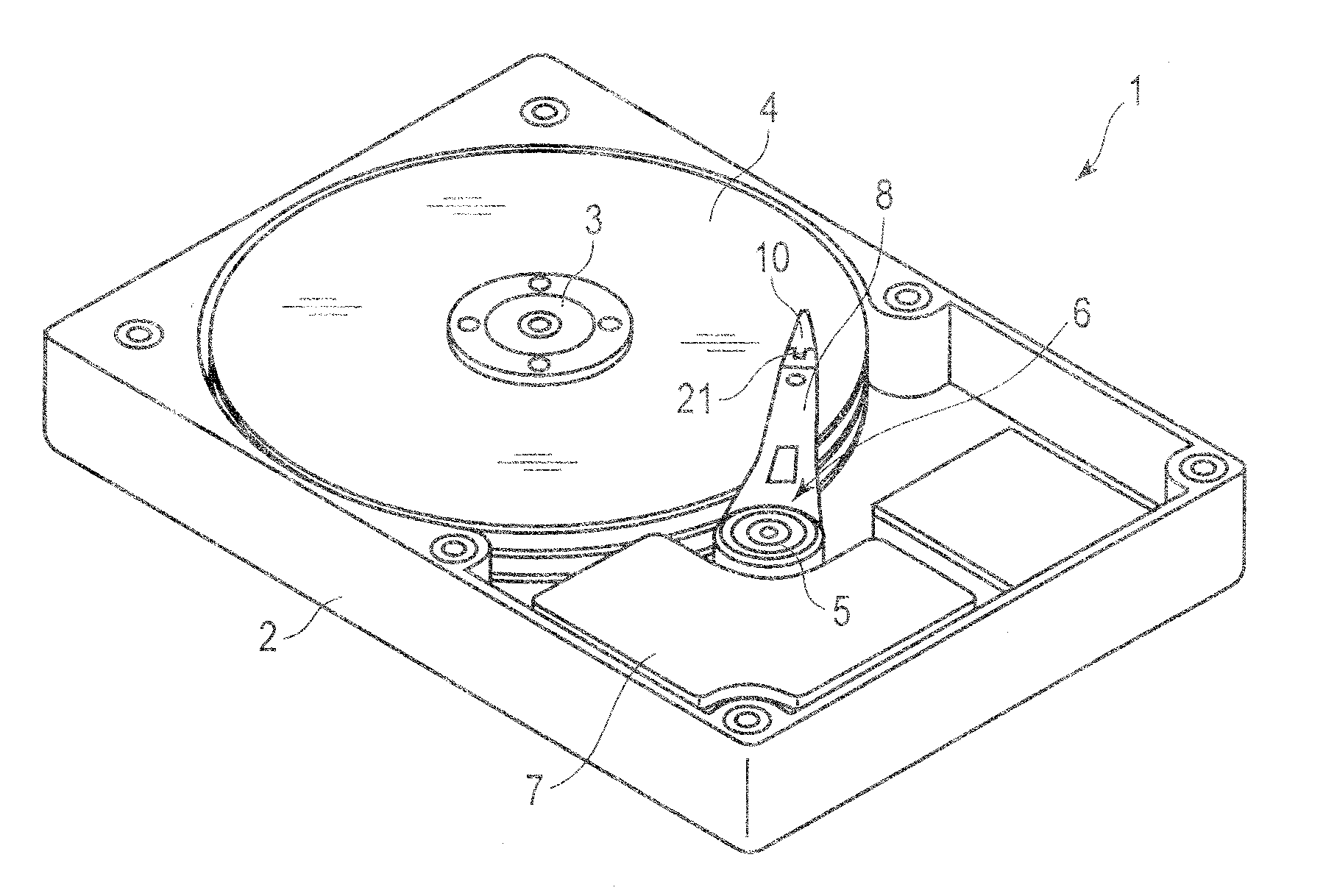

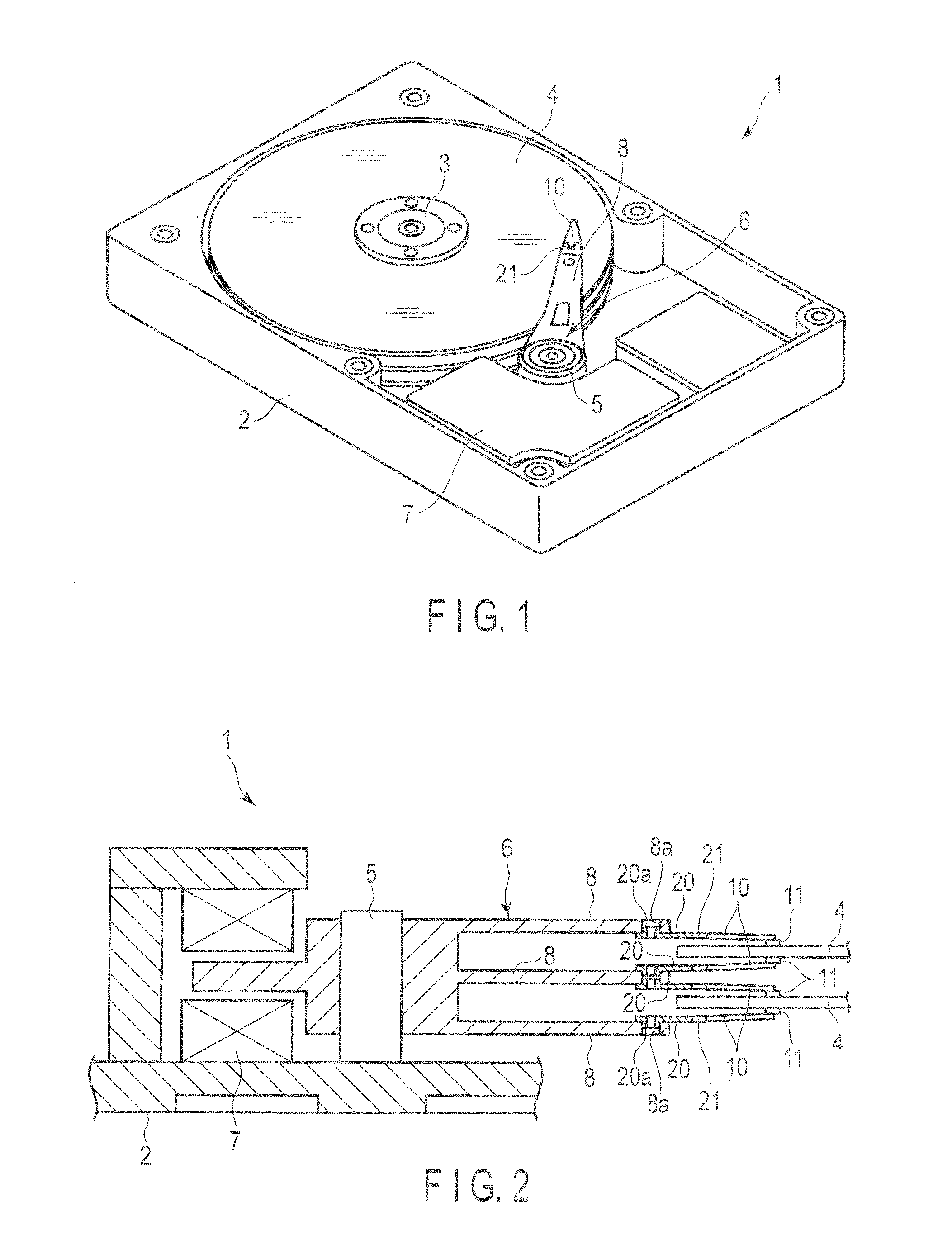

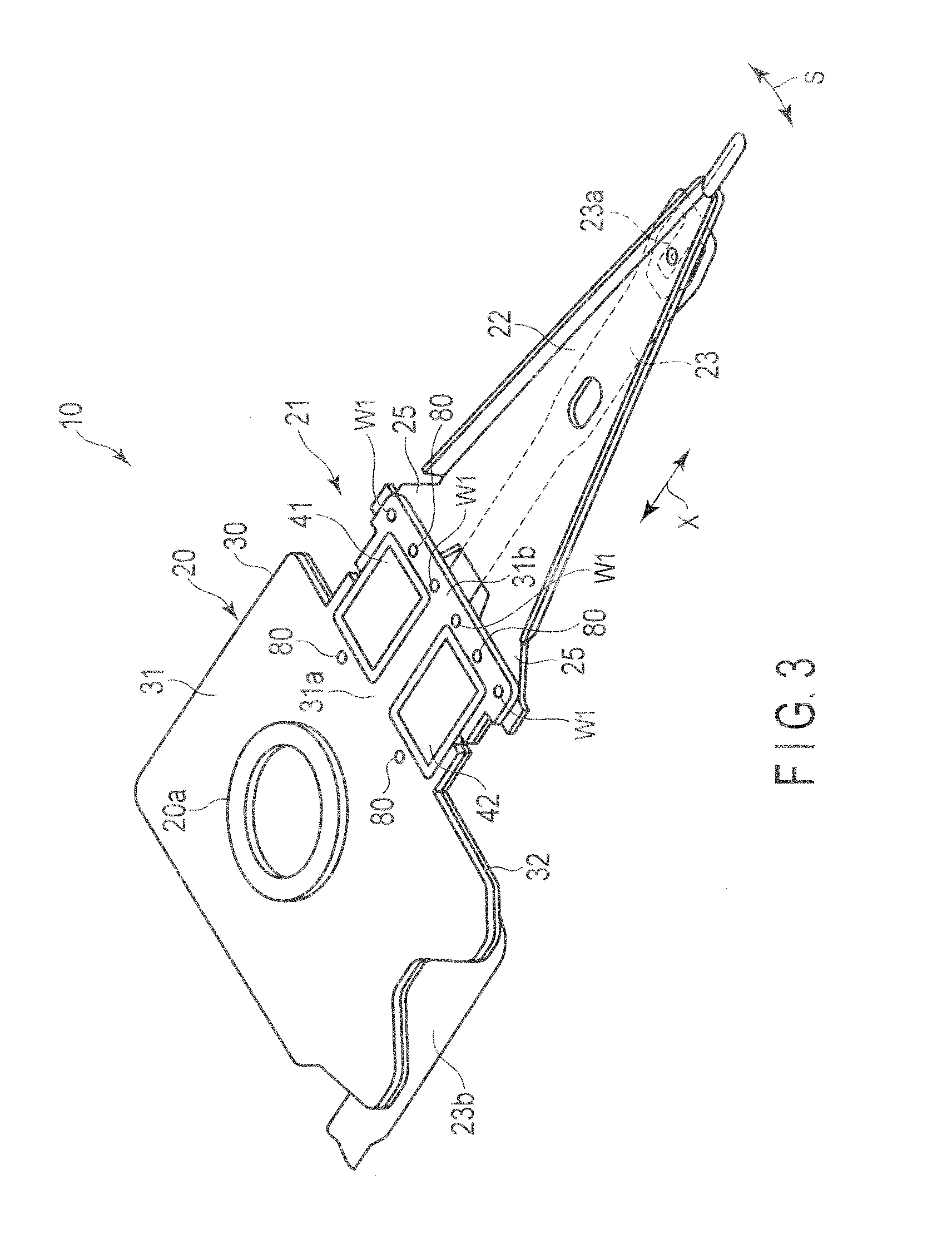

Disk drive suspension and manufacturing method therefor

ActiveUS20130301164A1Avoid rigidityLamination ancillary operationsArm with actuatorsAdhesiveEngineering

An actuator mounting section comprises a plate member includes a first plate and a second plate. The first plate is formed with an opening which accommodates an actuator element. The second plate comprises a main body portion which overlaps the first plate and supporting portions which support opposite ends of the actuator element. A narrow portion narrower than the first plate is formed at a part of the main body portion of the second plate. A weld seal portion is formed by laser-welding the first plate and the second plate at the narrow portion. Adhesive is provided between the opposite ends of the actuator element and an inner surface of the opening of the first plate.

Owner:NHK SPRING CO LTD

Battery pack mounting structure for electric vehicle

ActiveUS20130319780A1Increase the number ofReduce stiffnessHybrid vehiclesElectric propulsion mountingElectrical batteryElectric vehicle

There is provided a battery pack mounting structure for an electric vehicle. A battery pack is mounted in a space behind a rear seat of the electric vehicle. Battery modules are accommodated in the battery back are in a stacked state in a height direction of the electric vehicle. A floor panel behind the rear seat is formed with an opening into which an upper part of the battery pack is inserted. When seen from a side of the electric vehicle, a dimension of one battery module disposed at a position protruding upwards from the opening, is smaller in the longitudinal direction than that of another battery module disposed below the one battery module, and a front end portion of the one battery module is offset towards a rear side of the electric vehicle relative to that of the another battery module.

Owner:SUZUKI MOTOR CORP

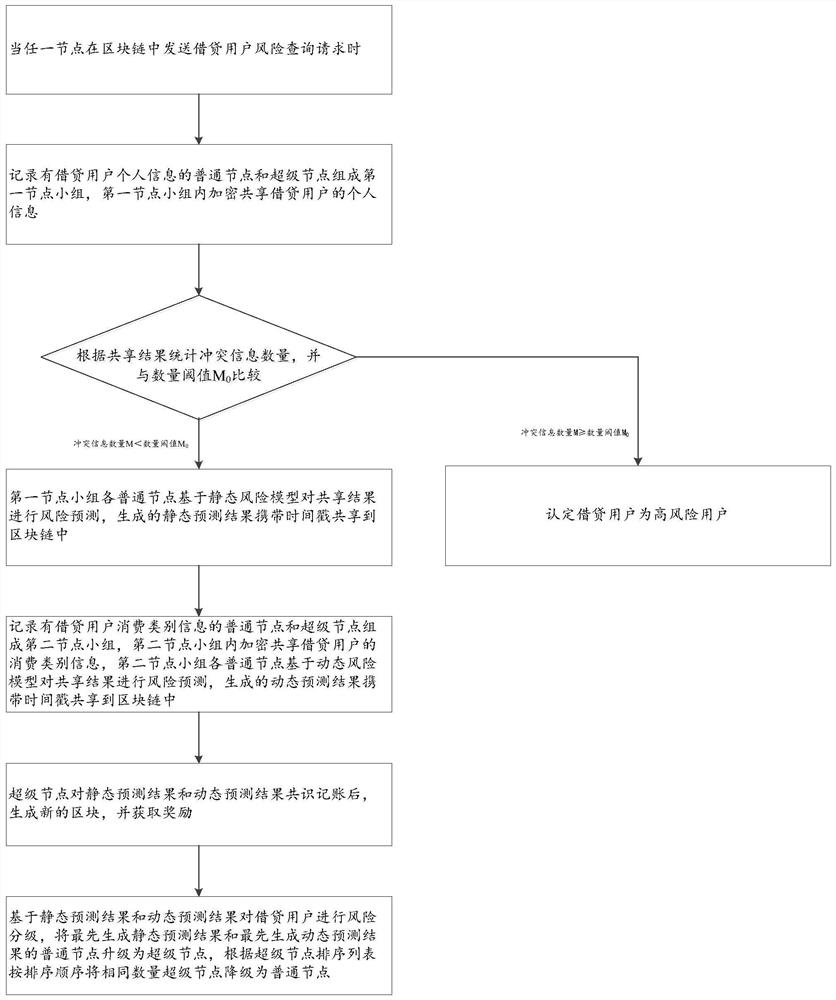

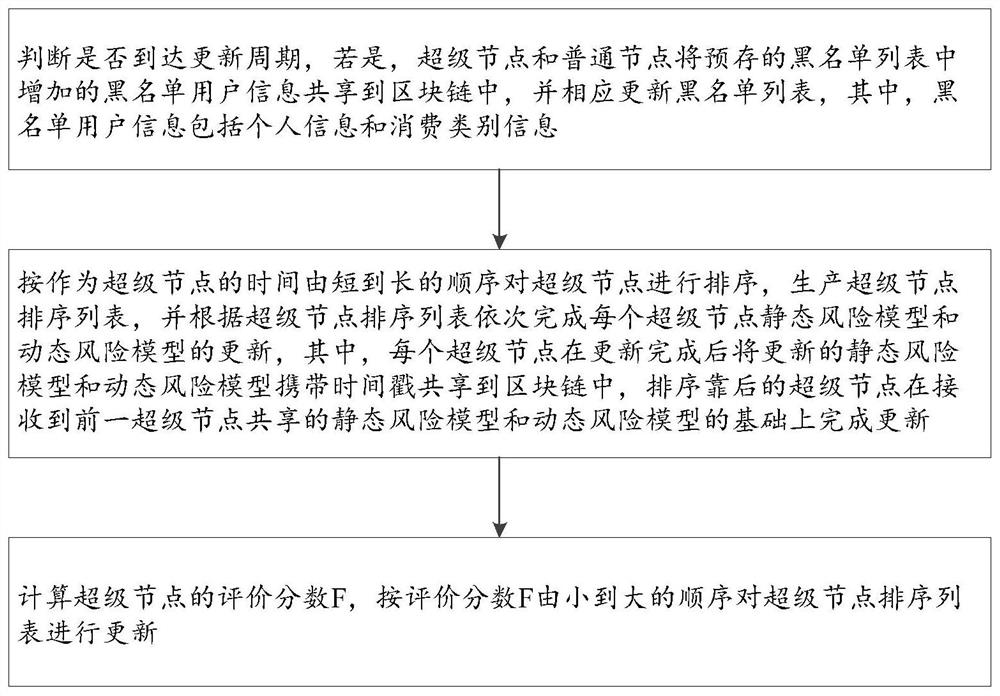

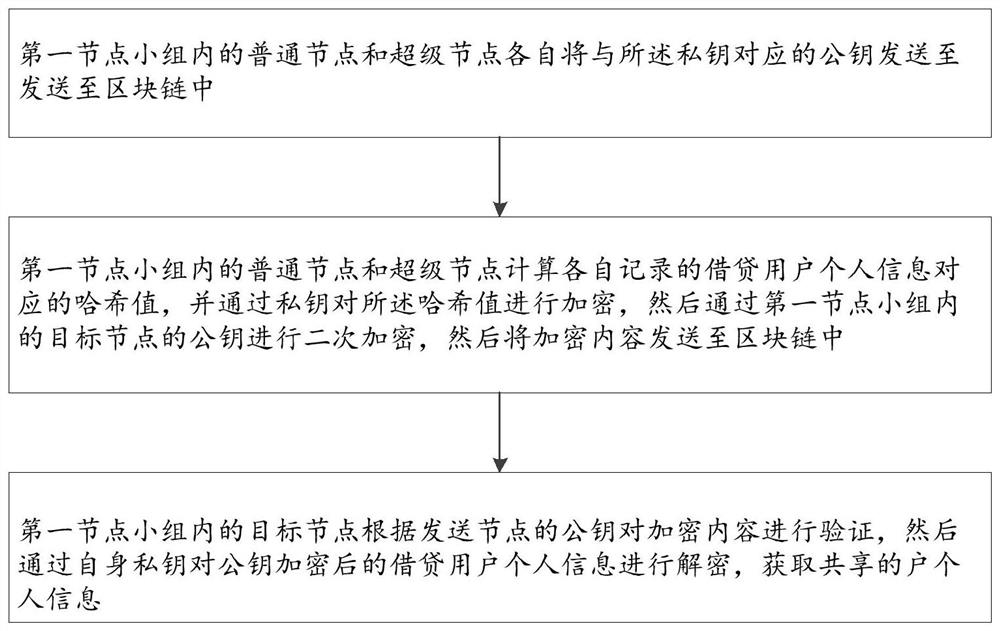

Financial loan auditing method and system based on block chain and machine learning

ActiveCN112465627AOvercome the illsRealize blacklist sharing synchronizationFinanceForecastingRisk modelRisk identification

The invention discloses a financial loan auditing method and system based on a block chain and machine learning, which are applied to a block chain network and comprise super nodes and common nodes. The method comprises the following steps: when any node queries a request, counting the quantity of conflict information, and carrying out risk grading on loan users based on a static prediction resultand a dynamic prediction result; and upgrading the common nodes which generate the static prediction result at the earliest and the dynamic prediction result at the earliest into super nodes, and degrading the same number of super nodes into the common nodes according to a super node sorting list and a sorting sequence. According to the invention, the defects of information islands of traditionalplatforms are overcome, user blacklist sharing synchronization is realized, and joint auditing of users for loans is realized; through combined auditing of a static risk model and a dynamic risk model, the influence of subjective factors of manual auditing is avoided, and the accuracy and the growth of risk identification are ensured; by adjusting the super nodes, the super nodes can be preventedfrom being rigidified and doing wrong jointly.

Owner:中科柏诚科技(北京)股份有限公司

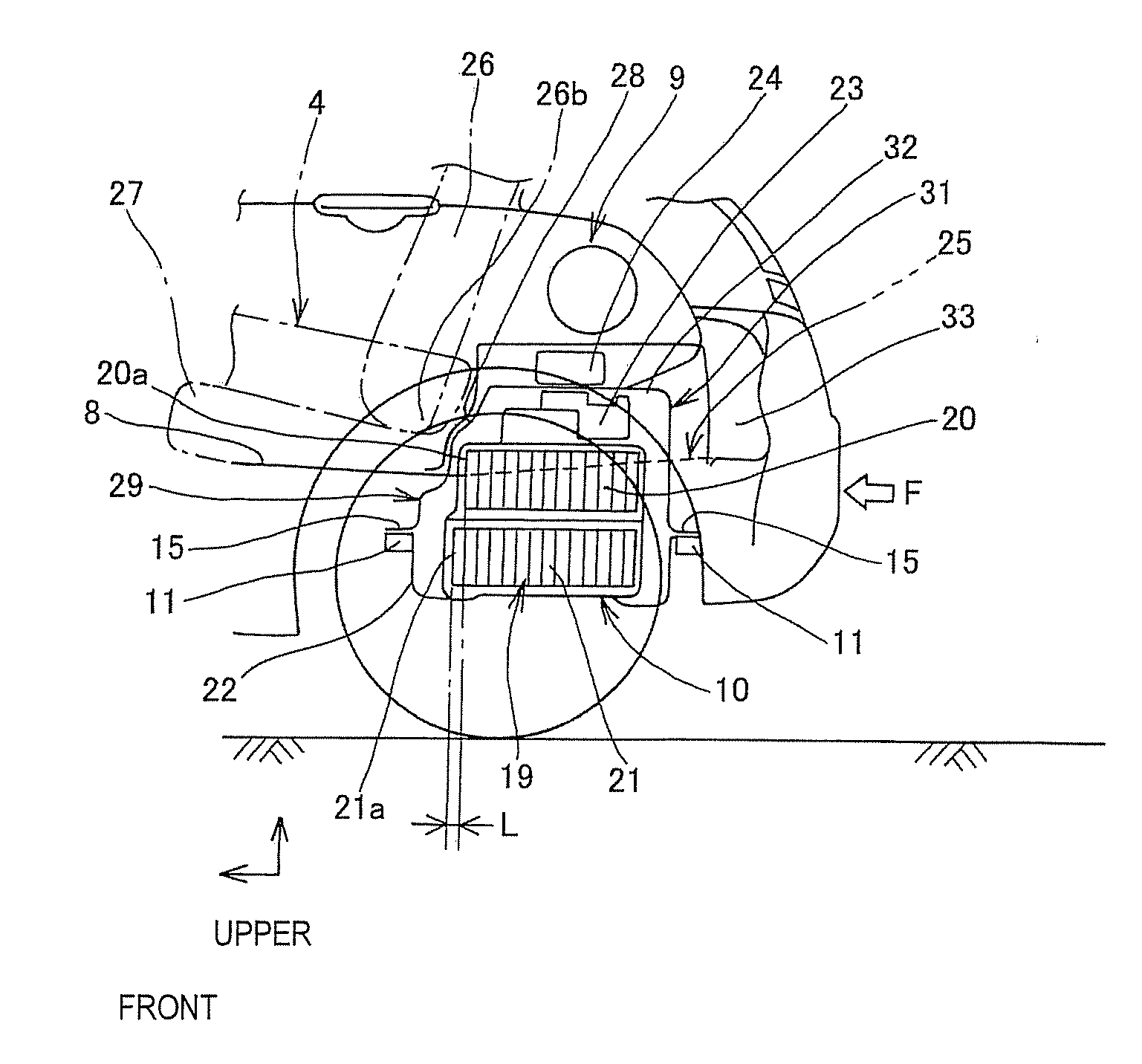

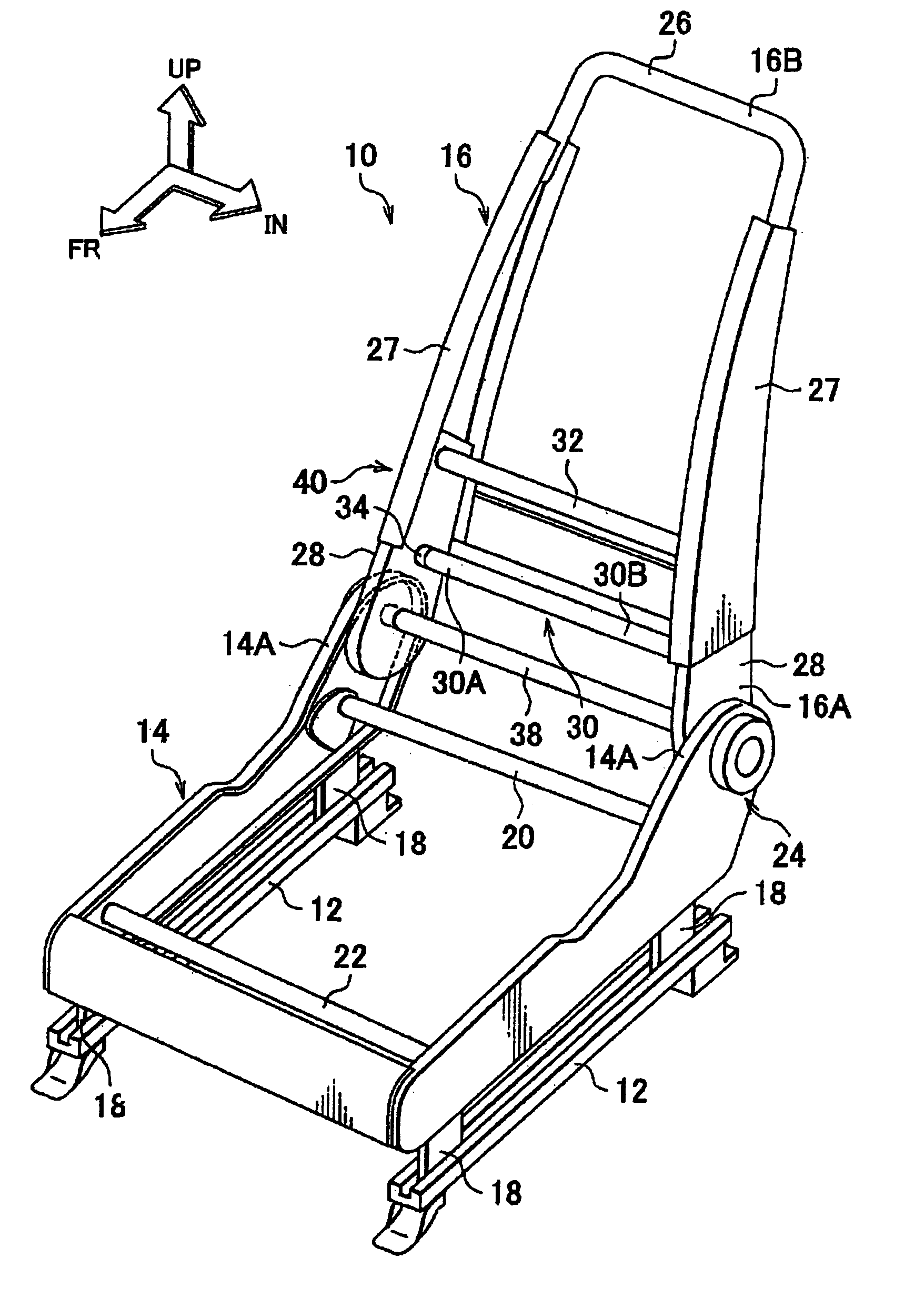

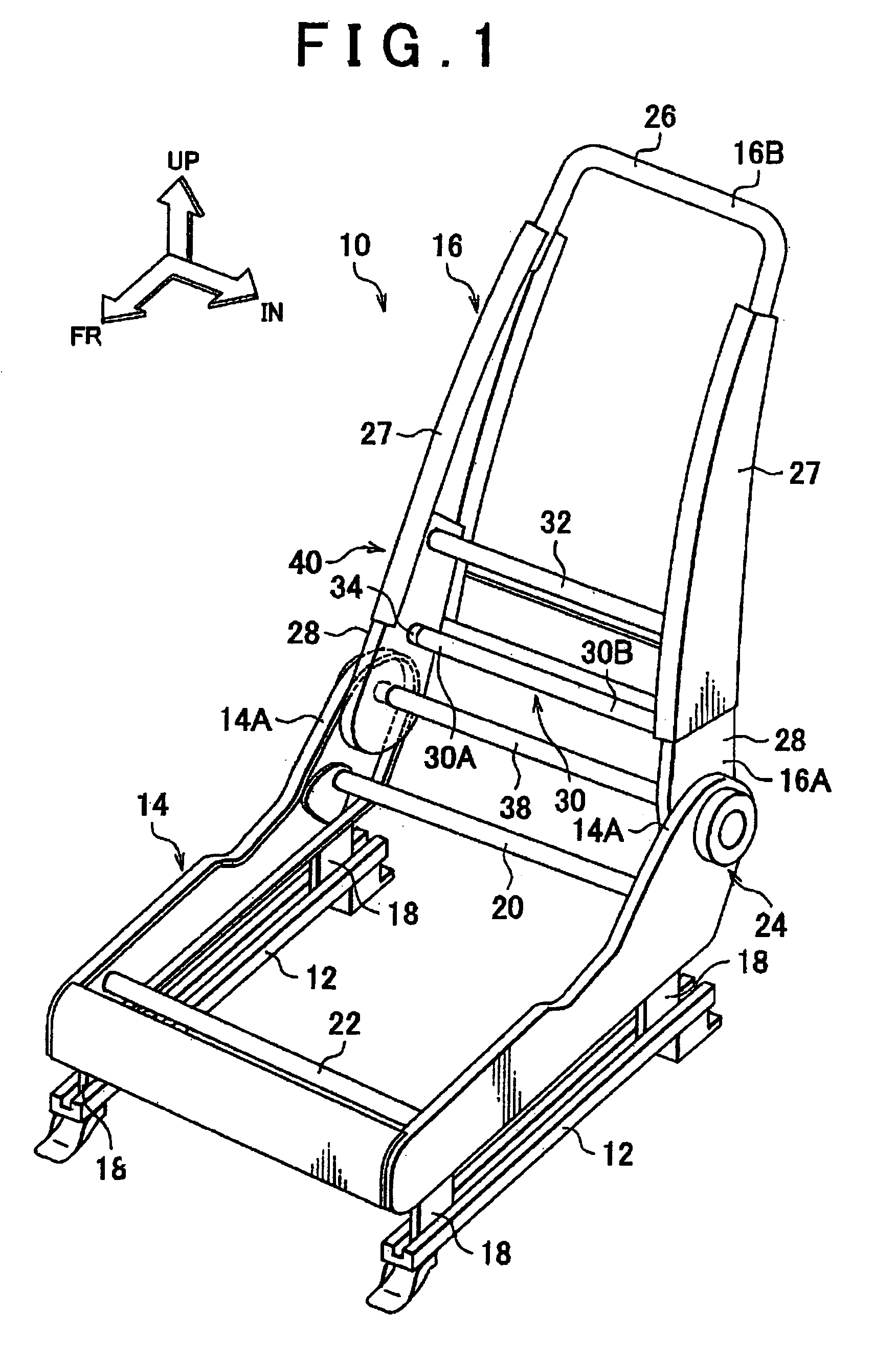

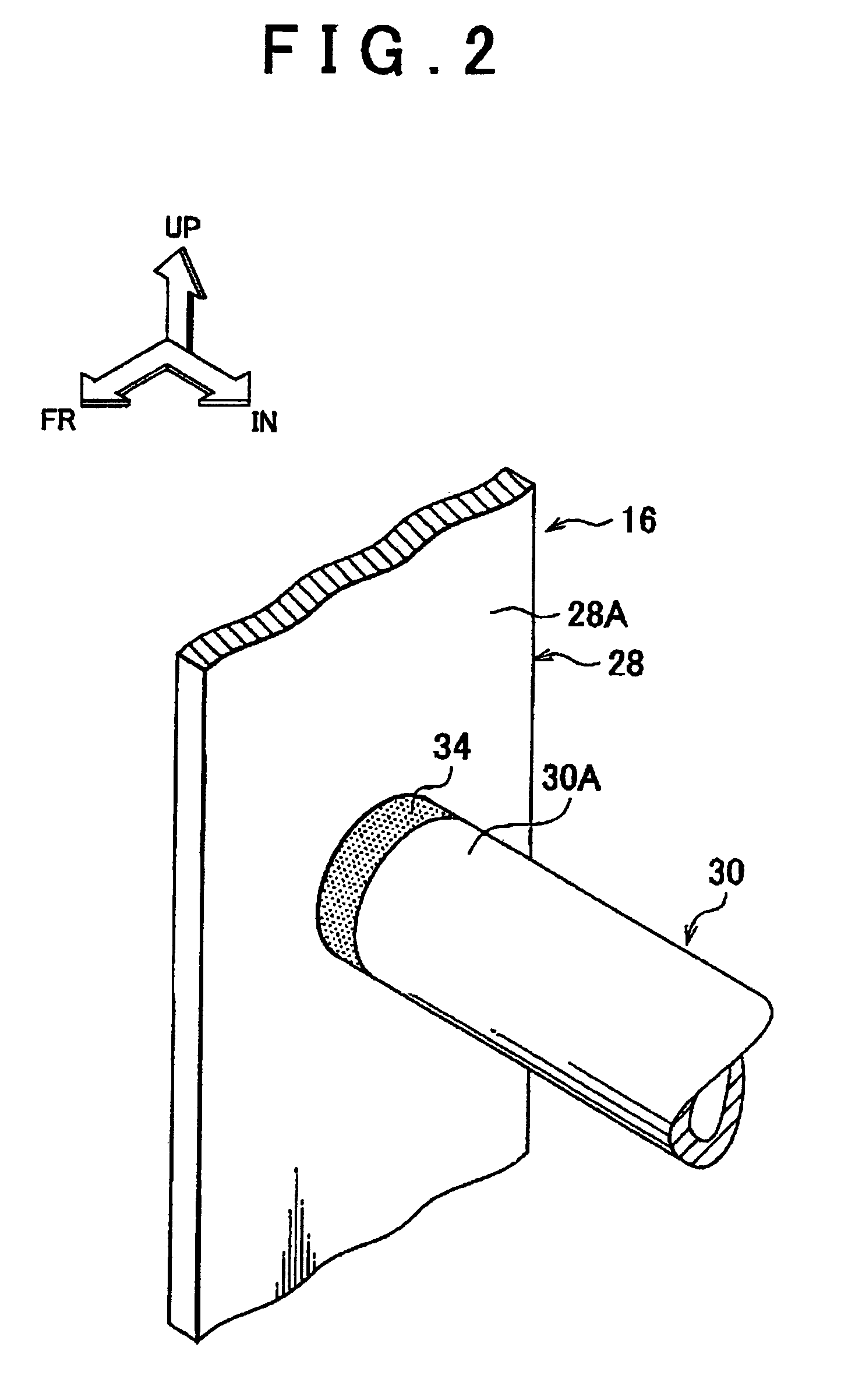

Vehicle seat

InactiveUS8833849B2Reduce vibrationRigid enoughPedestrian/occupant safety arrangementSeat framesEngineeringMechanical engineering

Owner:TOYOTA JIDOSHA KK

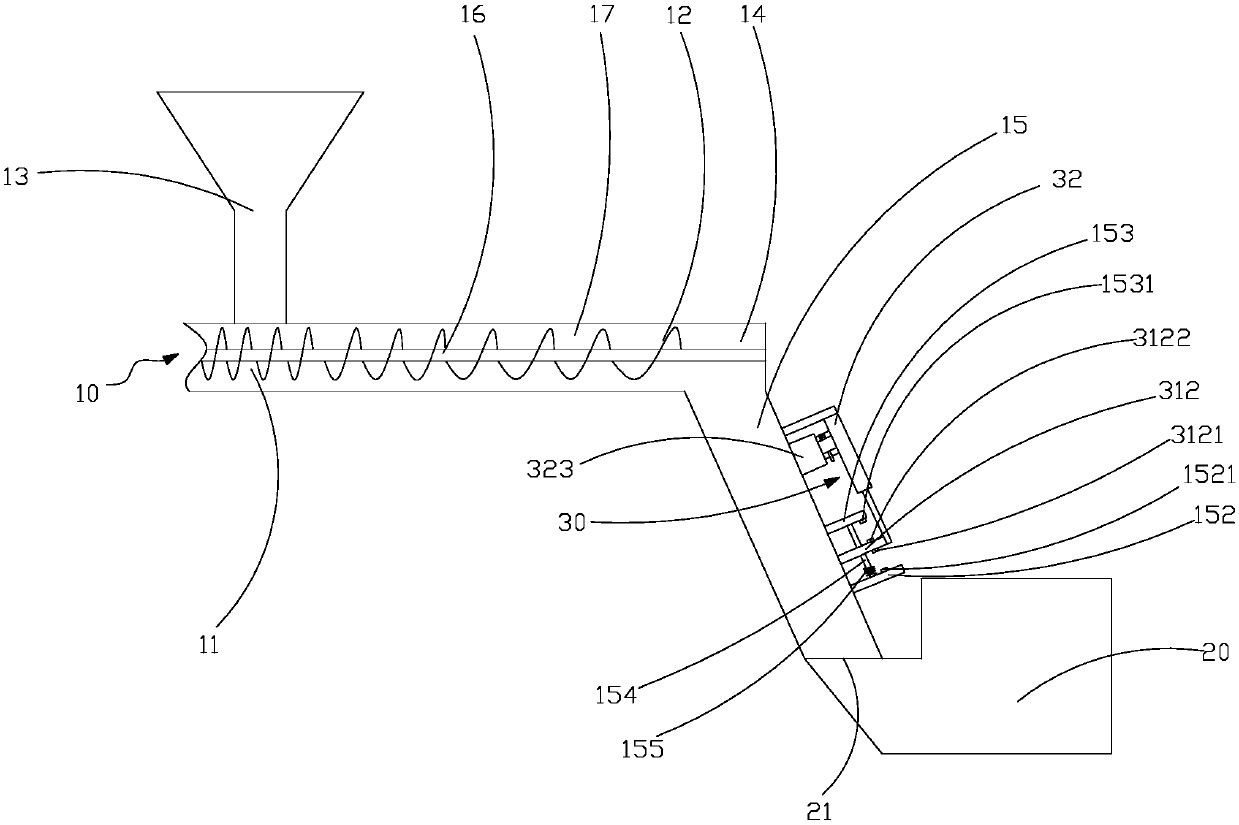

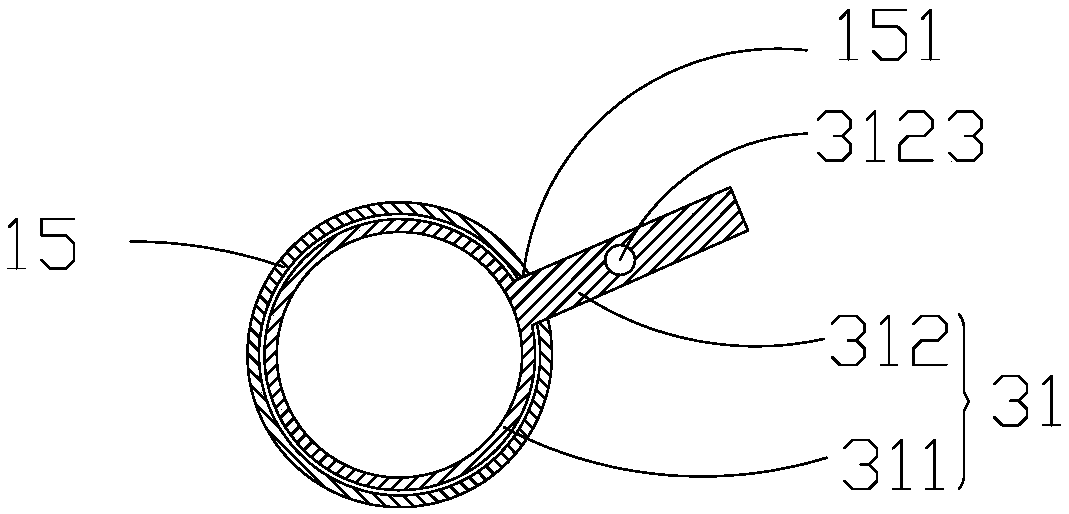

Coal conveying device

PendingCN109607239AReduce accumulationPrevent coal cloggingPackagingLoading/unloadingScrew conveyorCoal

The invention discloses a coal conveying device used for conveying coal into a boiler. The coal conveying device comprises a screw conveyor and an anti-blockage assembly. A screw and a plurality of spiral blades are arranged in the screw conveyor. The screw pitches between every two adjacent spiral blades are gradually increased in the material conveying direction. One end of the screw conveyor isconnected with a conveying pipeline obliquely arranged between the screw conveyor and the boiler. The anti-blockage assembly comprises a stirring piece and a drive piece. The conveying pipeline is provided with a sliding groove. The stirring piece comprises a stirring part and a movable part, wherein the stirring part is arranged in the conveying pipeline in a sliding manner, and after the movable part penetrates out of the sliding groove in a sliding manner, the movable part is arranged at the outer portion of the conveying pipeline in a protruding manner and is connected with the drive piece. The screw pitches between every two adjacent spiral blades in the screw conveyor are gradually increased, stacking of coal in the screw conveyor is reduced, meanwhile, the stirring piece is arranged in the conveying pipeline in a sliding manner, and through reciprocating of the stirring piece in the conveying pipeline, coal blockage is prevented.

Owner:常州市长江热能有限公司

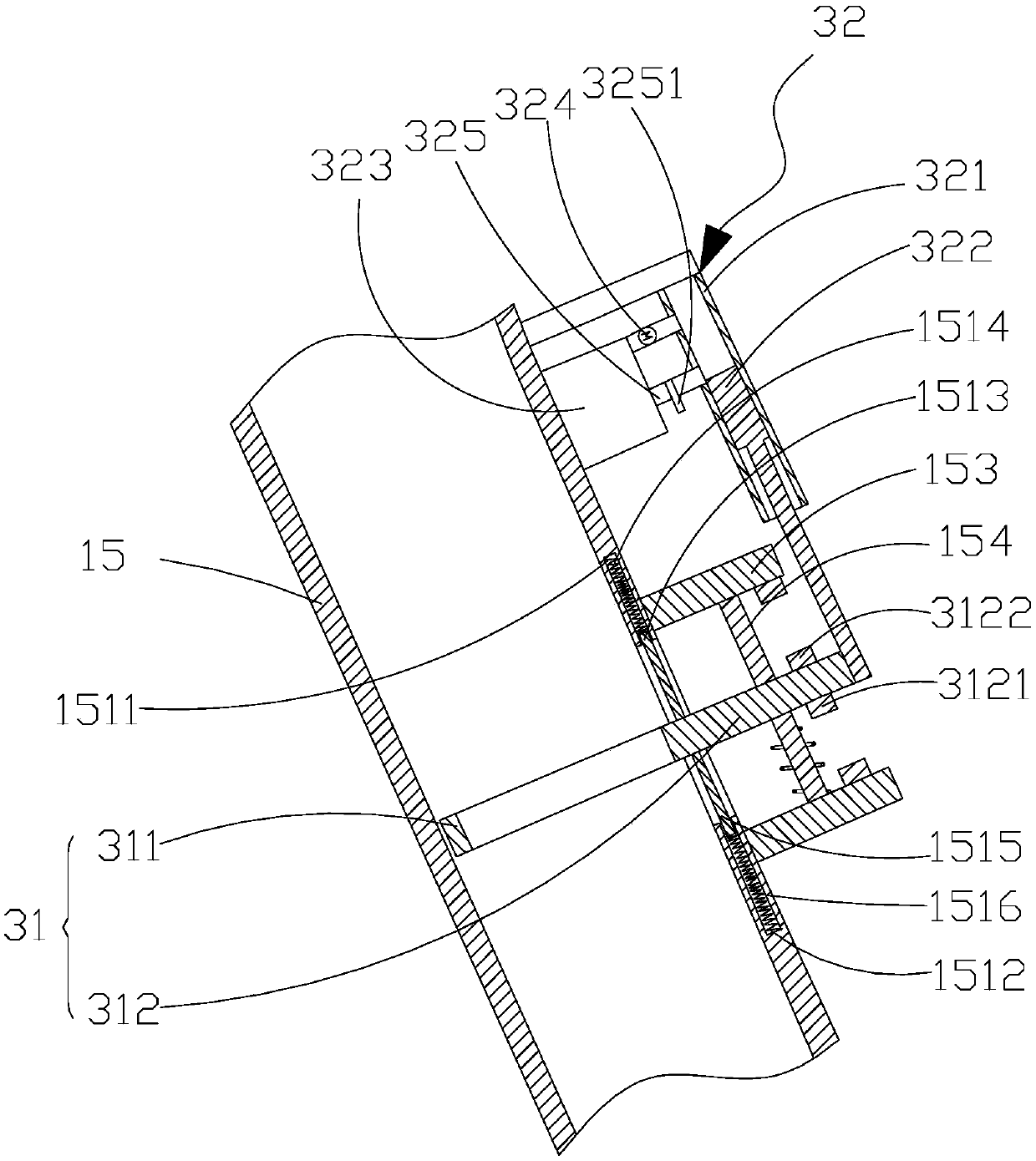

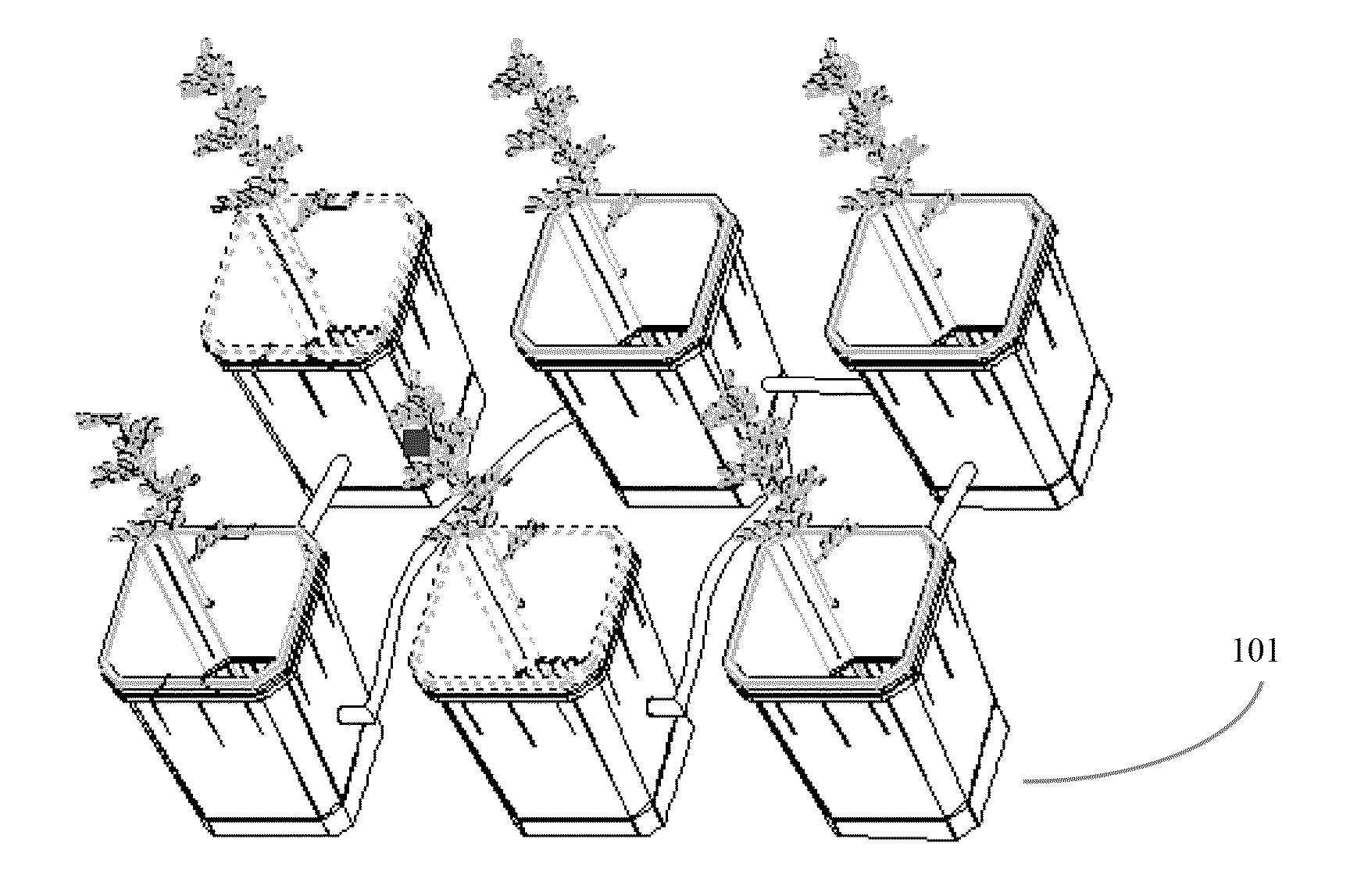

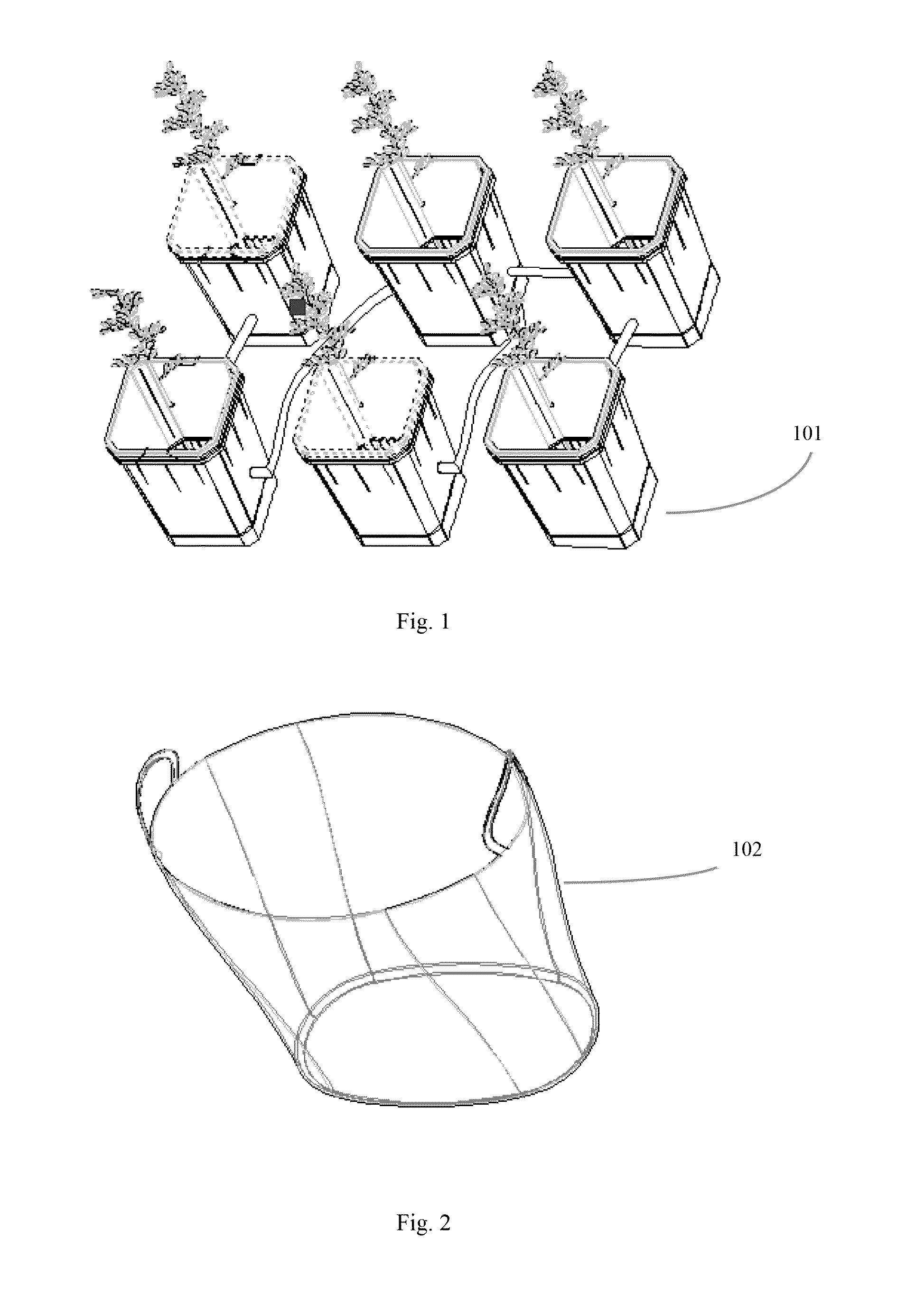

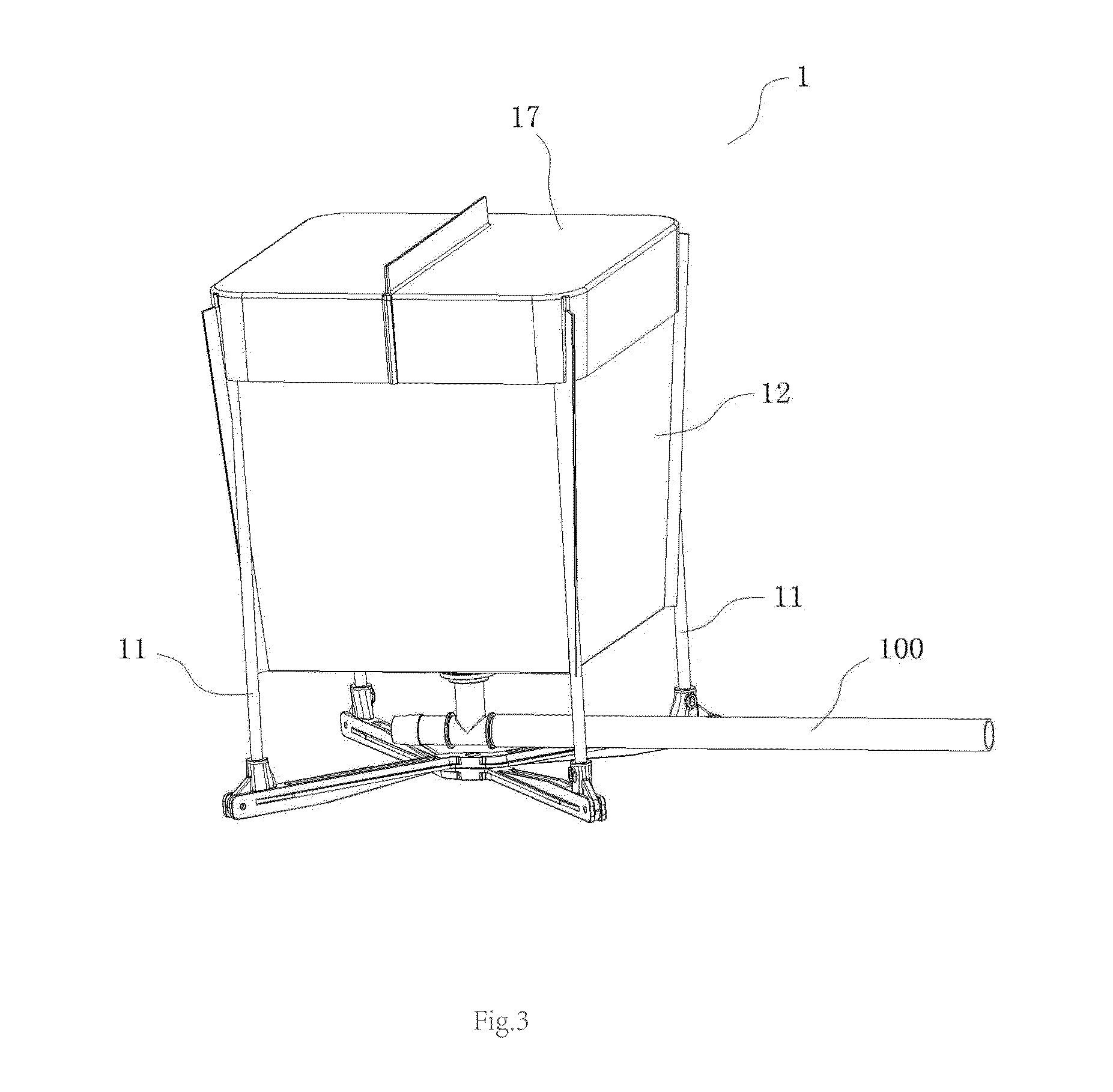

Flexible hydroponics growing model and system

InactiveUS20160235024A1Easy to storeSave spaceAgriculture gas emission reductionCultivating equipmentsComputer moduleEngineering

The invention introduces a flexible growth model of hydroponics including frame, growing modules and growing medium. The frame acts as a skeleton to provide support for the whole growing modules. The growing module is made of flexible materials to hold the hydroponics growing medium. The invention also provides a model of flexible hydroponic system, through which store less water (through the way of storing less water in each individual flexible growing modules). It effectively reduces the needed water pumped to the plants. The system can connect up to 48 growing modules, by using this system, users can save the needed water and nutrients ½ less than the present flood and drain system.

Owner:XIAMEN SUPERPRO TECH CO LTD

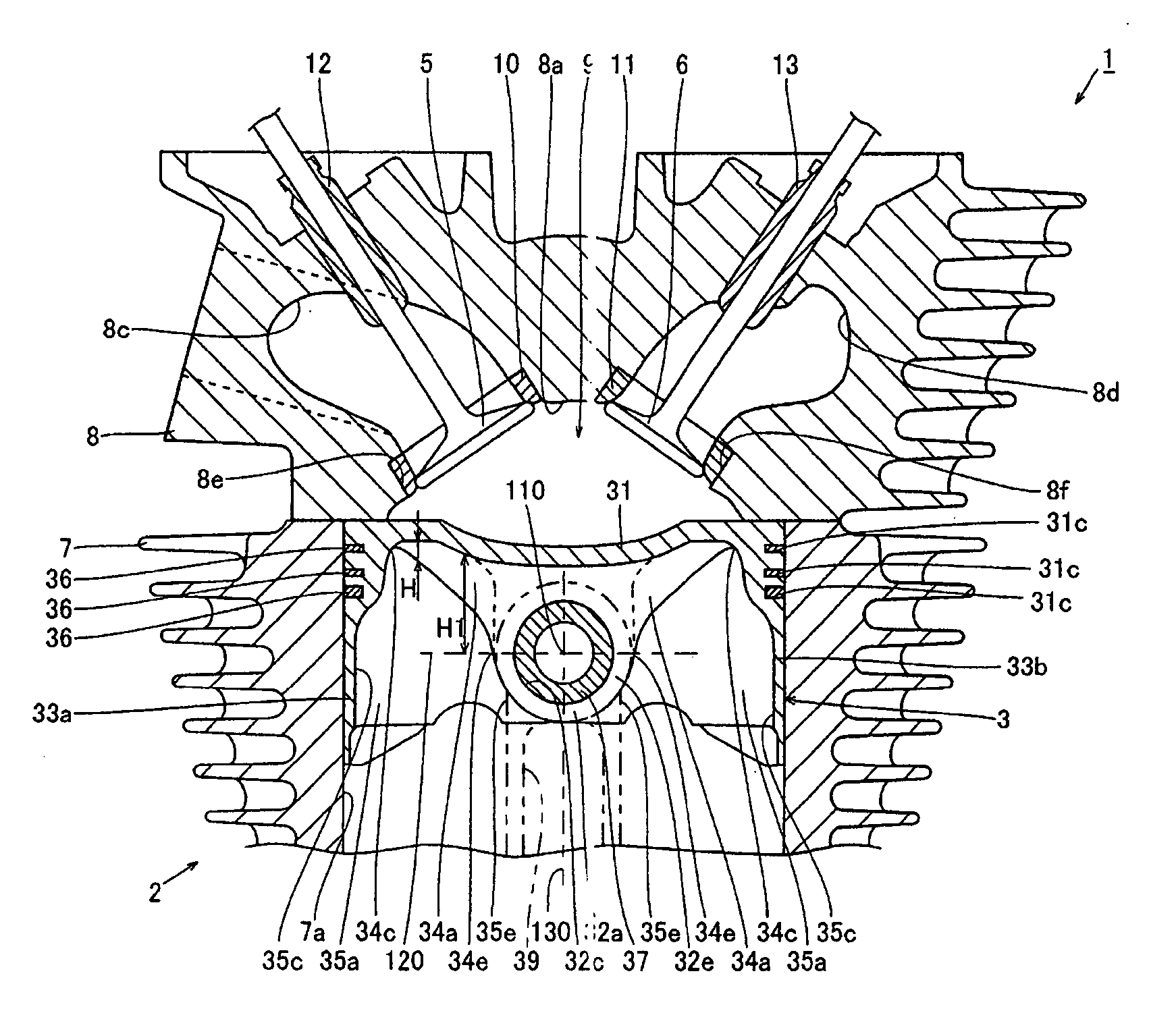

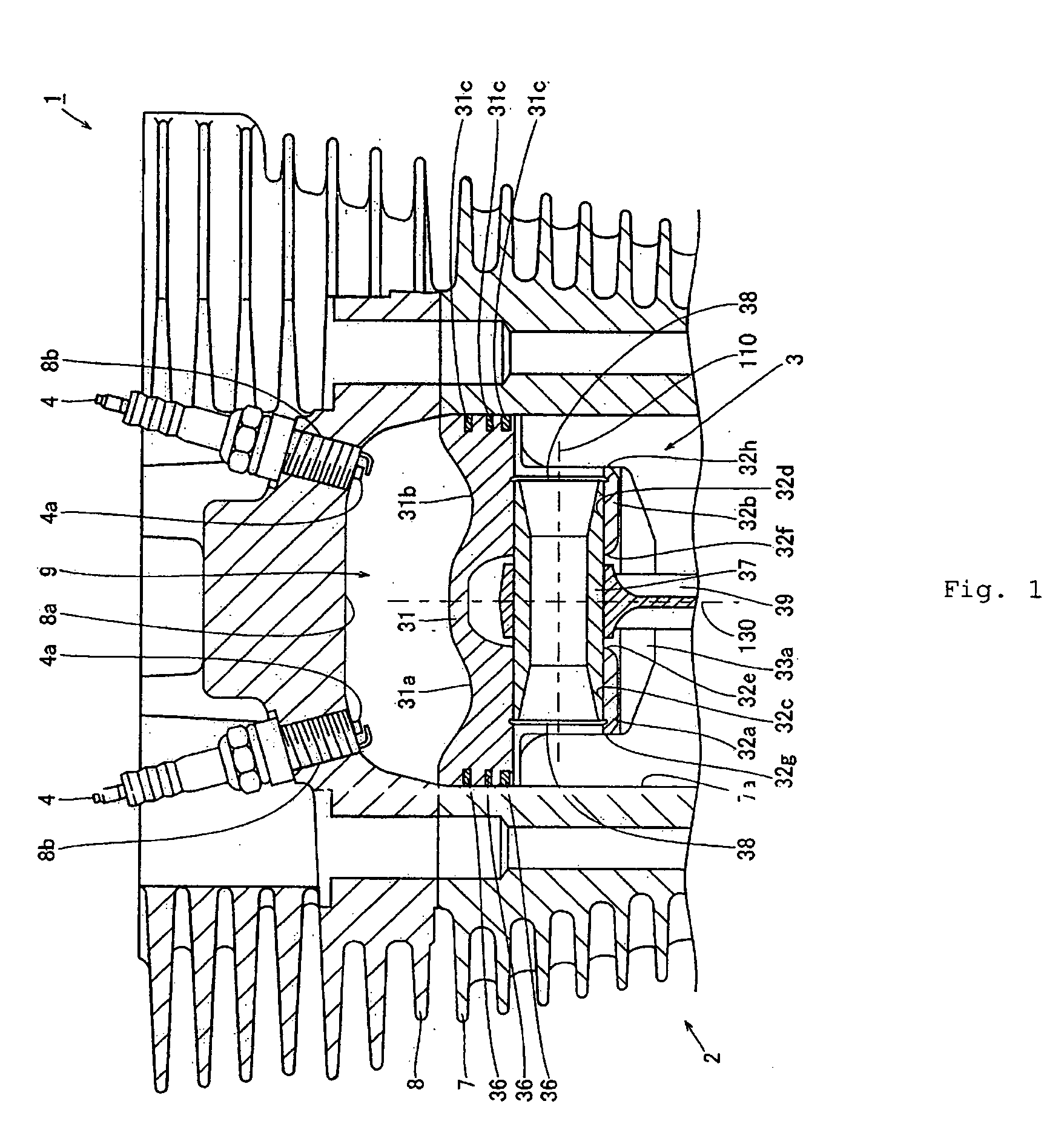

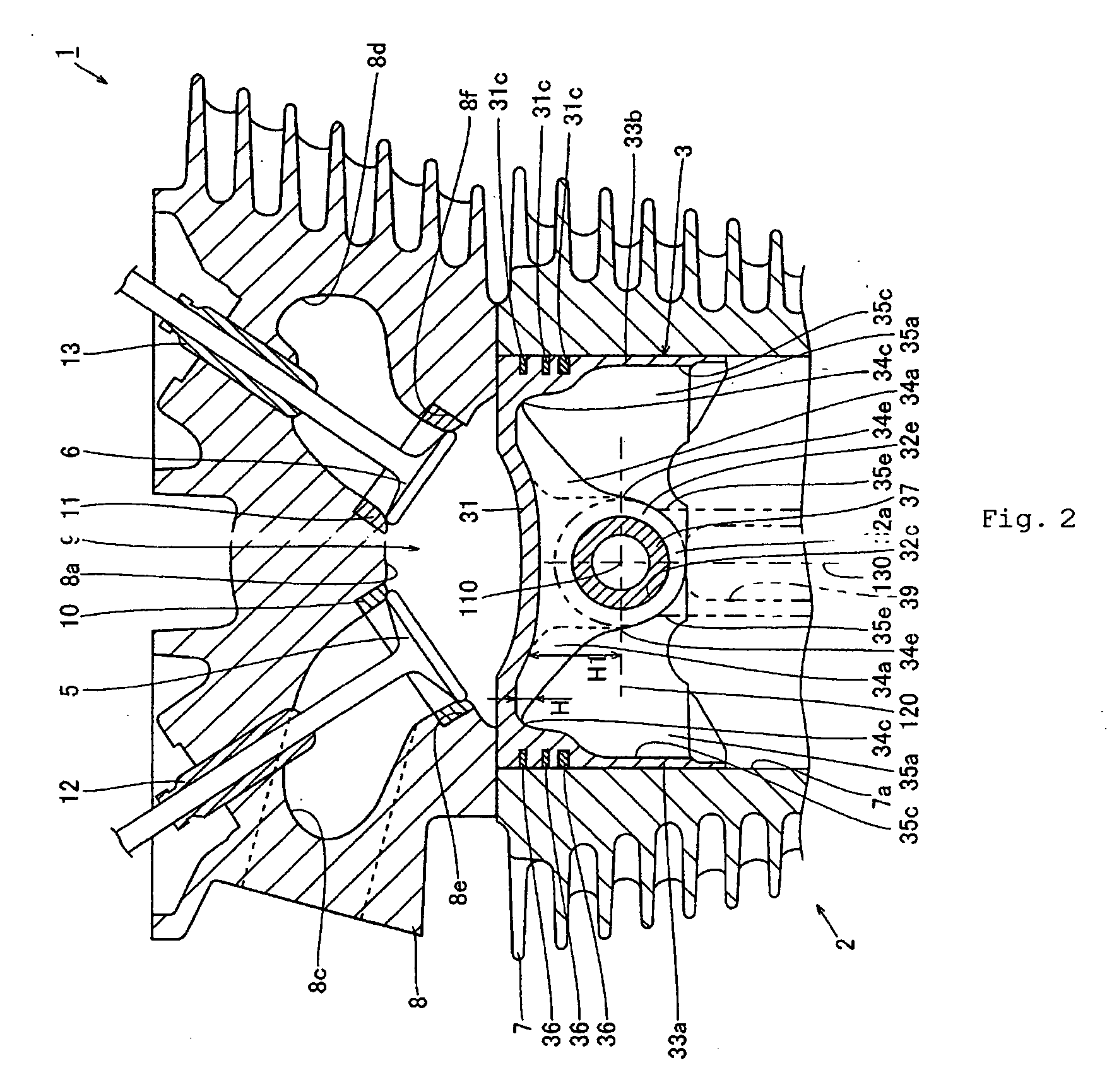

Internal combustion engine

InactiveUS20050188840A1Increase the sectionImprove rigidityPlungersMachines/enginesPistonEngineering

A piston is constructed to have improved rigidity yet be relatively light weight. The piston includes a head section having a surface on one side thereof and a rear or bottom surface on the opposite side thereof. At lease one piston pin inserting section is provided on the rear side of the head section and is configured to receive at least a portion of a piston pin of the engine. At least one rib joins together the rear surface of the head section and the piston pin inserting section to increase the rigidity of the piston.

Owner:YAMAHA MOTOR CO LTD

Tire

InactiveUS20140124116A1Avoid noiseImprove rolling resistancePneumatic tyre reinforcementsInflatable tyresTire beadEngineering

Owner:BRIDGESTONE CORP

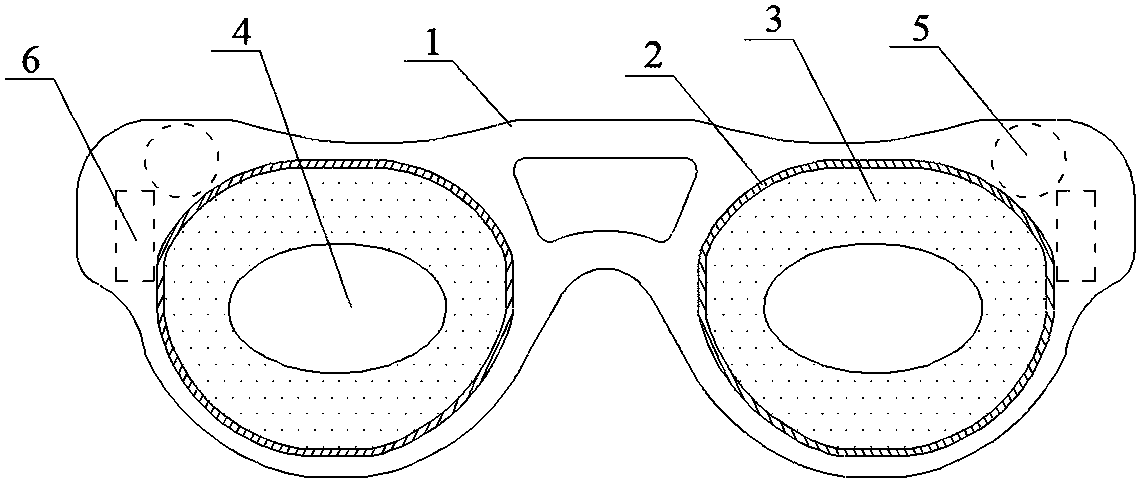

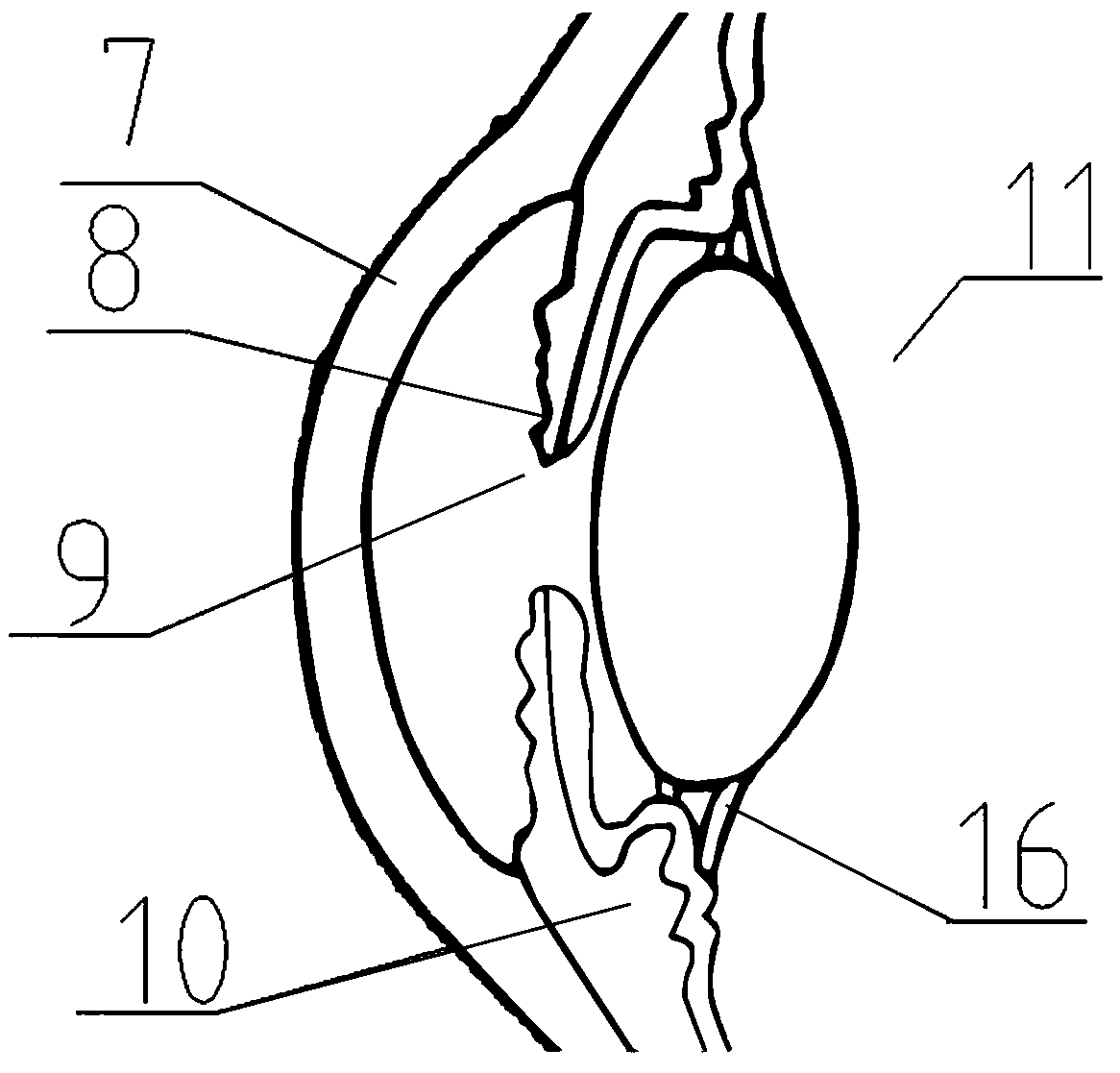

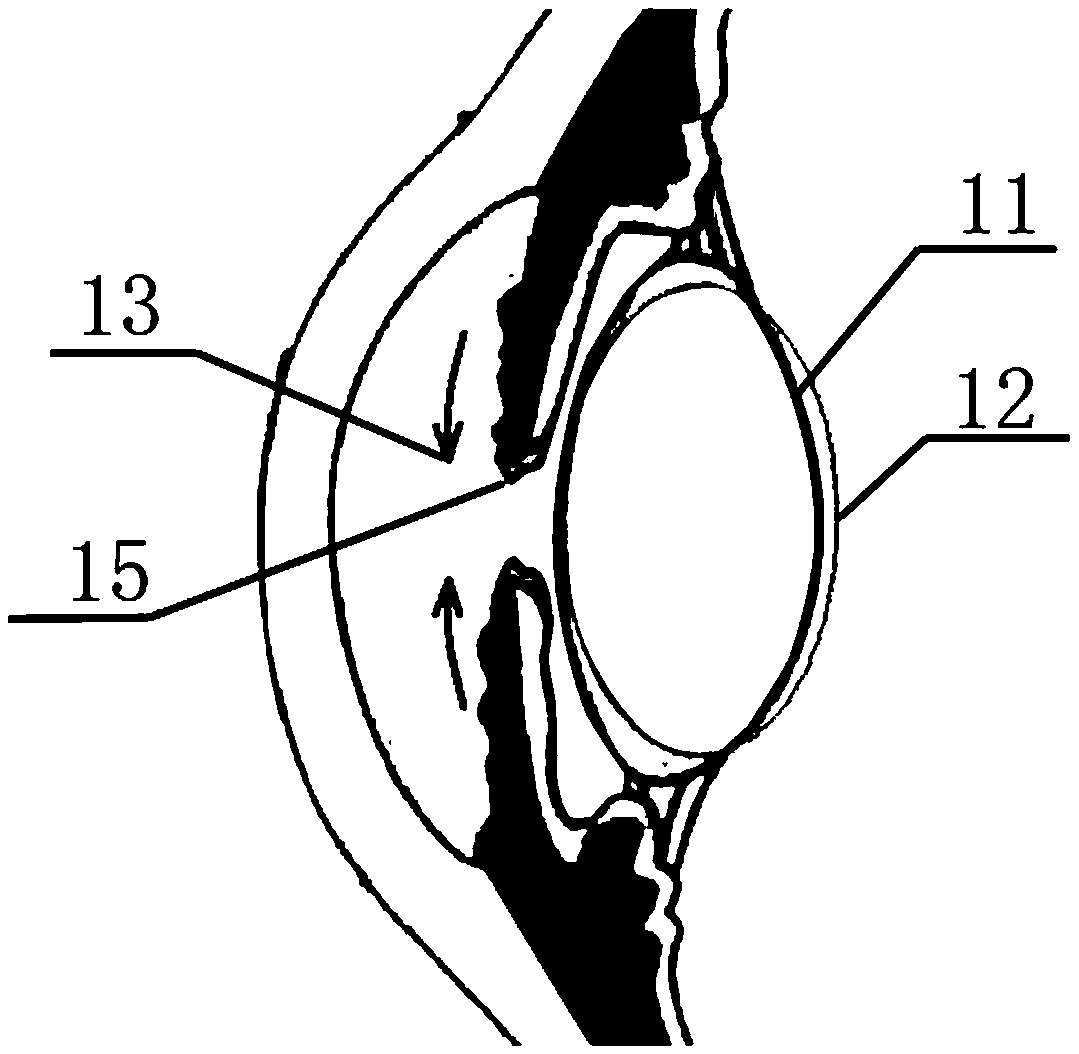

Glasses for exercising muscles in eyeballs through light intensity change to prevent myopia or presbyopia and application method of glasses

InactiveCN108743268AIncrease elasticityPrevent lengtheningEye exercisersLight energyNear sightedness

The invention discloses a pair of glasses for exercising muscles in eyeballs through light intensity change to prevent myopia or presbyopia and an application method of the glasses. The pair of glasses comprises a glasses frame and lenses. Each lens comprises a transparent area in the middle and a frosted area surrounding the periphery of the transparent area, wherein an LED backlight belt is arranged along the edge of the frosted area and used for illuminating the frosted area. The glasses frame is further provided with single-chip microcomputers used for adjusting the light intensity of theLED backlight belts, and batteries used for supplying power to the single-chip microcomputers. The frosted area can simulate dynamic light intensity during outdoor activities, and a person periodically looks closely and far through the center areas of the lenses, so that ciliary muscles periodically contract, then crystalline lenses periodically compress and stretch, the function of exercising muscles around the crystalline lenses is achieved, and the effect of improving the elasticity of the crystalline lenses is achieved. Besides, retinas adjust correspondingly, so that stiffness and lengthening of axis oculi are avoided. The LED backlight belts provide part of light energy for books or objects in front for dynamic illumination, and an optical detector is arranged and matched with ambient light for control; the glasses are safe and convenient to use.

Owner:NANCHANG UNIV

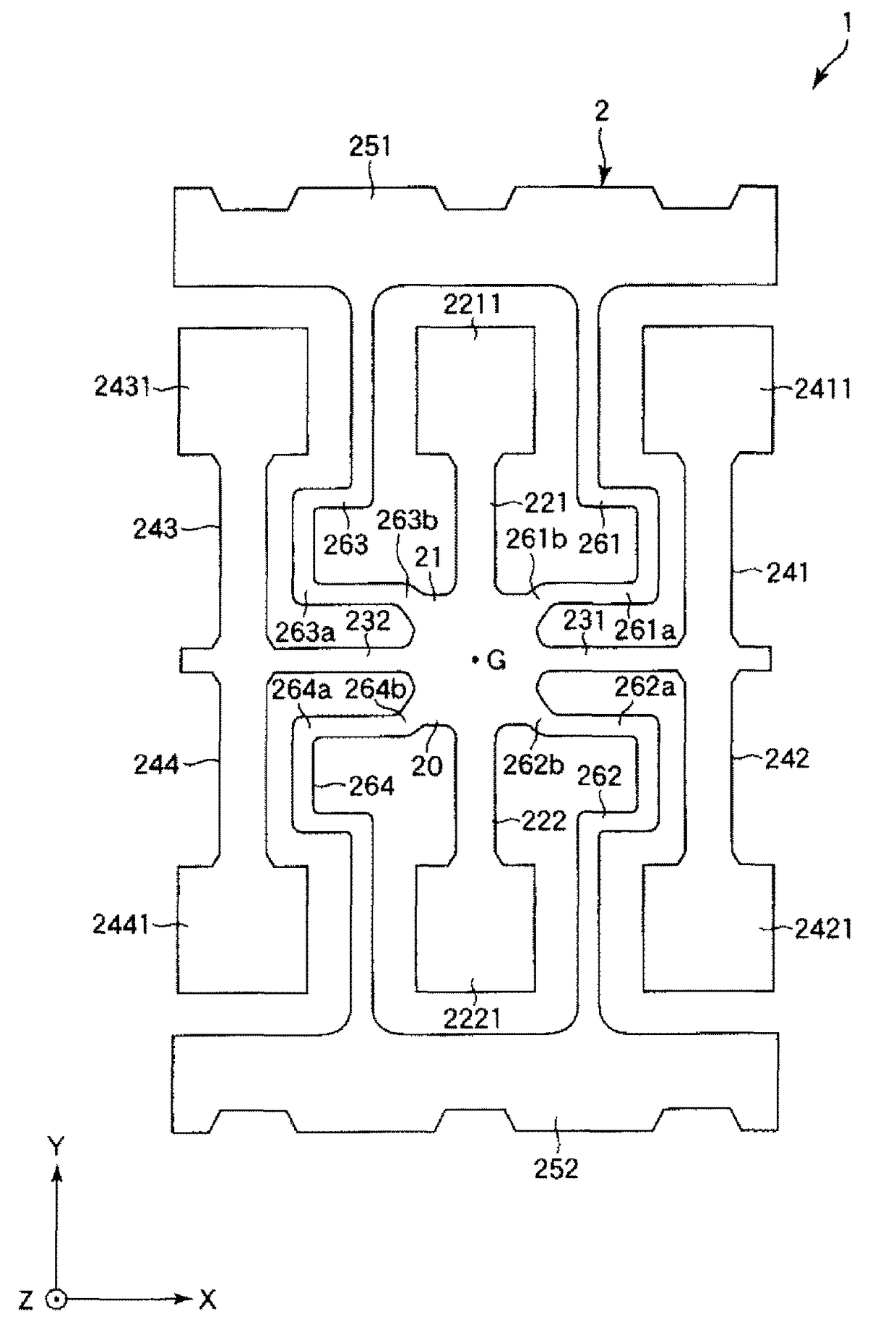

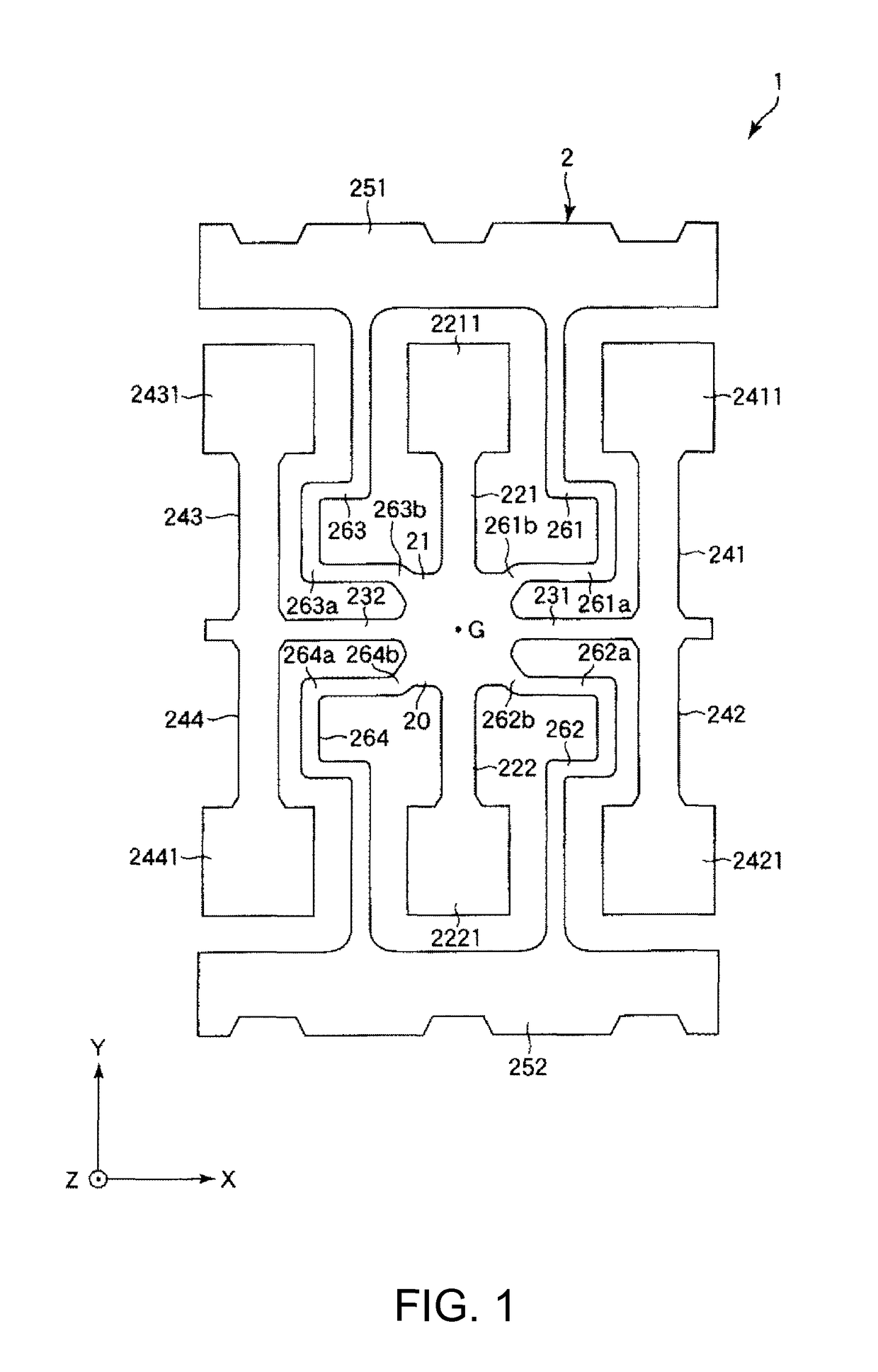

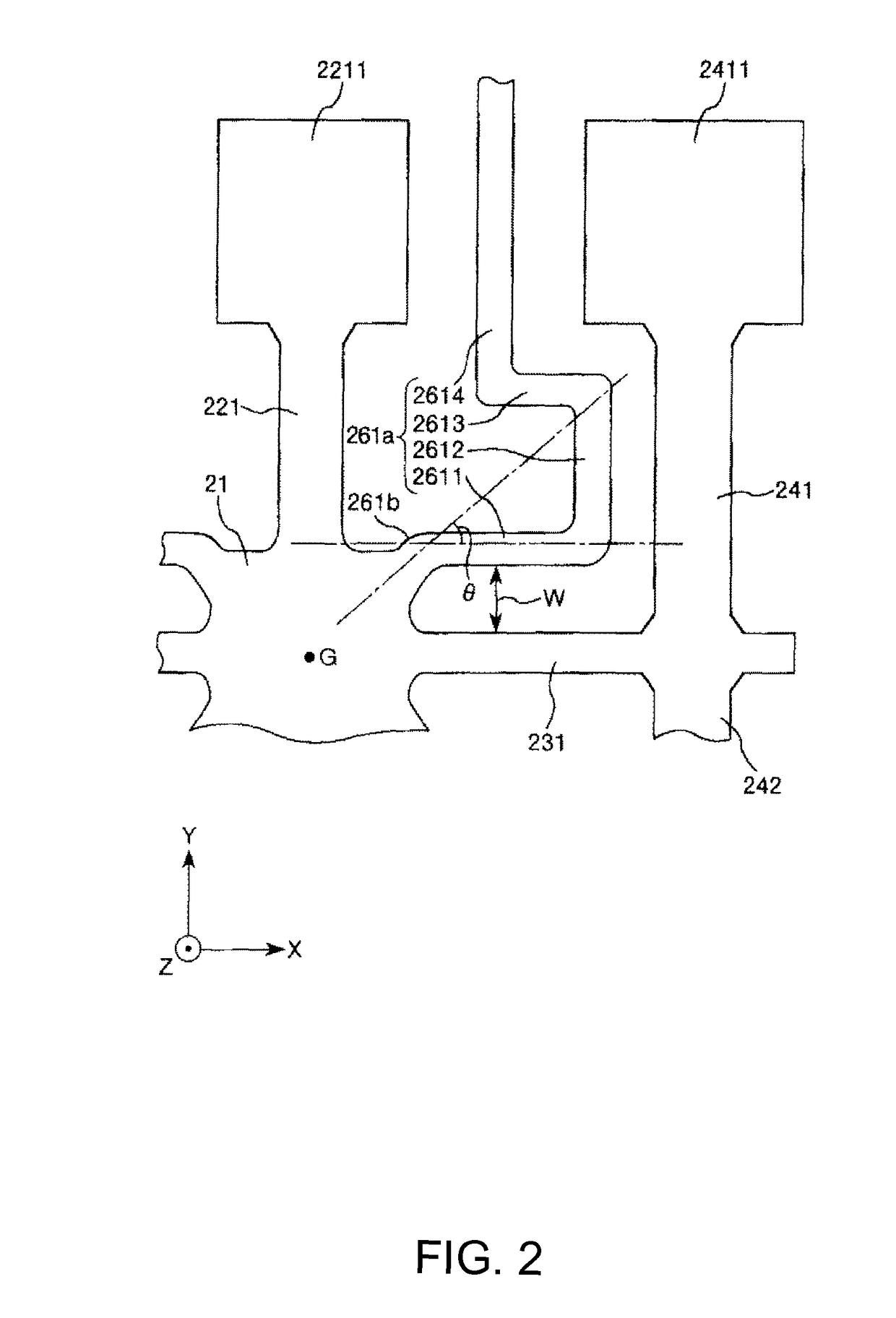

Vibration element, vibrator, vibration device, electronic device and moving object

ActiveUS9631926B2High mechanical strengthAvoid rigiditySpeed measurement using gyroscopic effectsTurn-sensitive devicesCantileverMechanical engineering

Owner:SEIKO EPSON CORP

Release paint for artificial leather and release paper prepared by utilizing release paint

InactiveCN102816467AImprove the simulation effectAvoid rigidityCoatings with pigmentsCoatingsCoated surfaceRelease liner

The invention discloses release paint for artificial leather and release paper prepared by utilizing the release paint. The release paint comprises particle components, an average particle size of each particle component is 20-500mum; and the release paper consists of base paper and a bottom coating layer and a release coating layer which are subsequently attached on one side of the base paper surface, the release coating layer is formed by consolidation after being coated with the release paint comprising the particle components, and an average particle size of each particle component is larger than a thickness of the release coating layer. By the adoption of the release paint for artificial leather and the release paper prepared by utilizing the release paint, since irregular distributing bulges are formed on the release coating layer surface of the particle components, irregular distributing pores are correspondingly formed on the artificial leather surface manufactured by utilizing the release paper, higher simulation effects are provided, and the sense of rigidity caused by manual splicing decorative patterns is avoided.

Owner:浙江池河科技有限公司

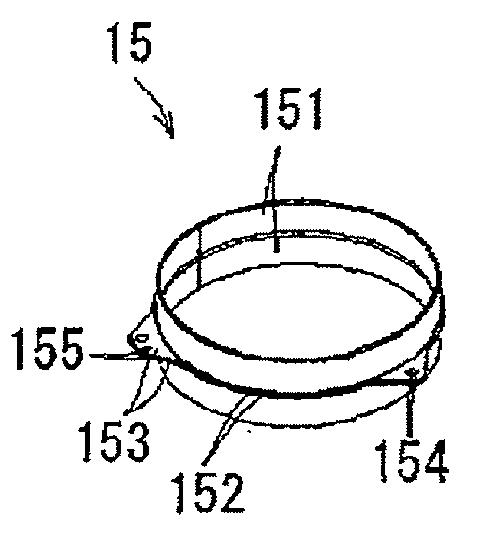

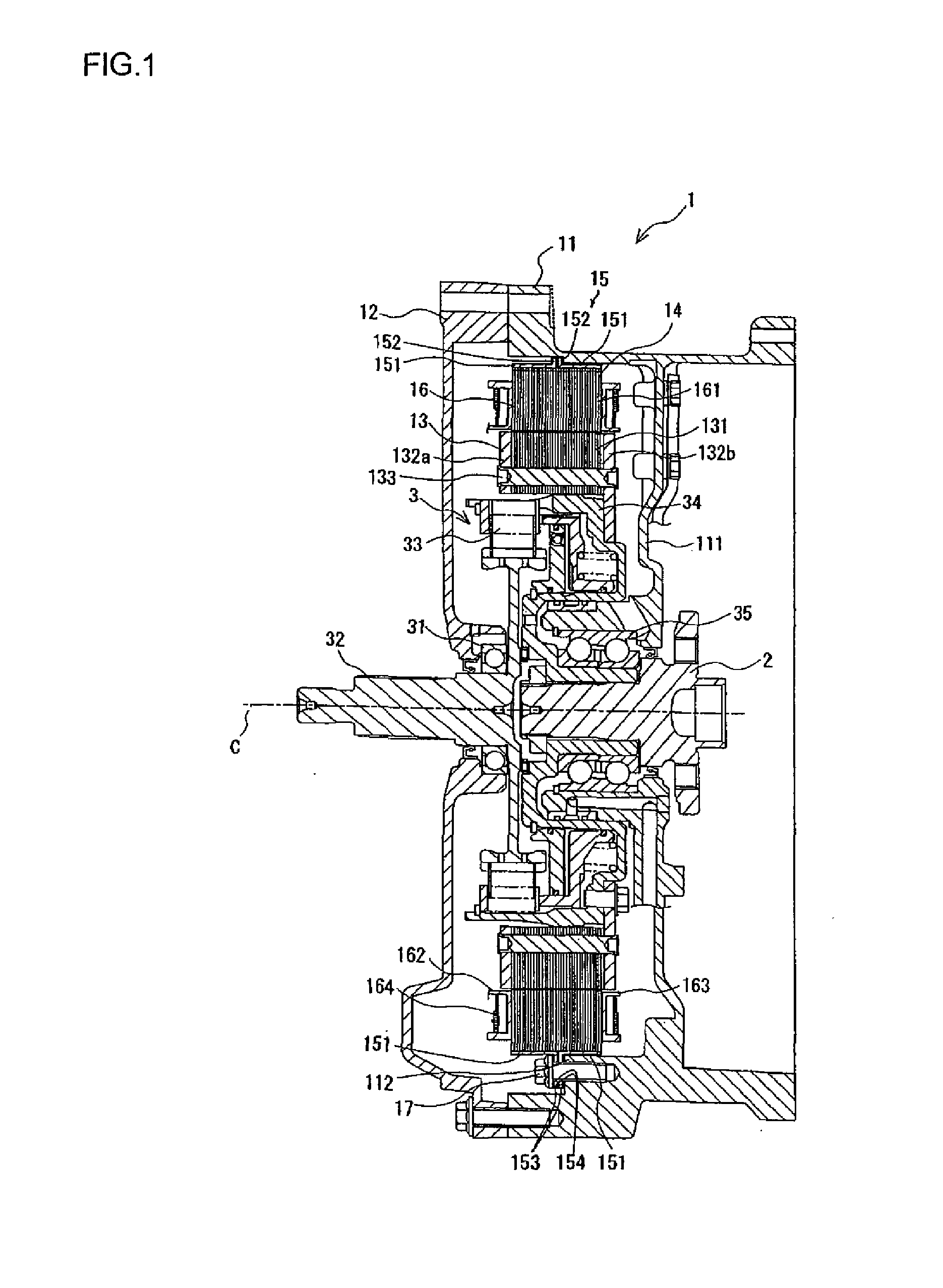

Rotational electric machine and method for manufacturing retaining ring for the same

InactiveUS20130020902A1Avoid rigidityReduce harmMagnetic circuit stationary partsManufacturing dynamo-electric machinesElectric machineSurface pressure

A rotational electric machine comprises a stator having a plurality of cores arranged in an annular ring shape and a retaining ring capable of retaining the plurality of cores on an inner circumferential surface so that a surface pressure is applied to an outer circumferential surface of the plurality of cores. The rotational electric machine further comprises a rotor provided radially inside of the stator facing the plurality of cores in a radial direction and rotatable relative to the stator. The stator and the rotor are mounted on a housing. The retaining ring is provided with a flange portion. The flange portion is formed on an axial middle portion of an outer circumferential surface of the retaining ring and to be attachable to the housing.

Owner:AISIN SEIKI KK

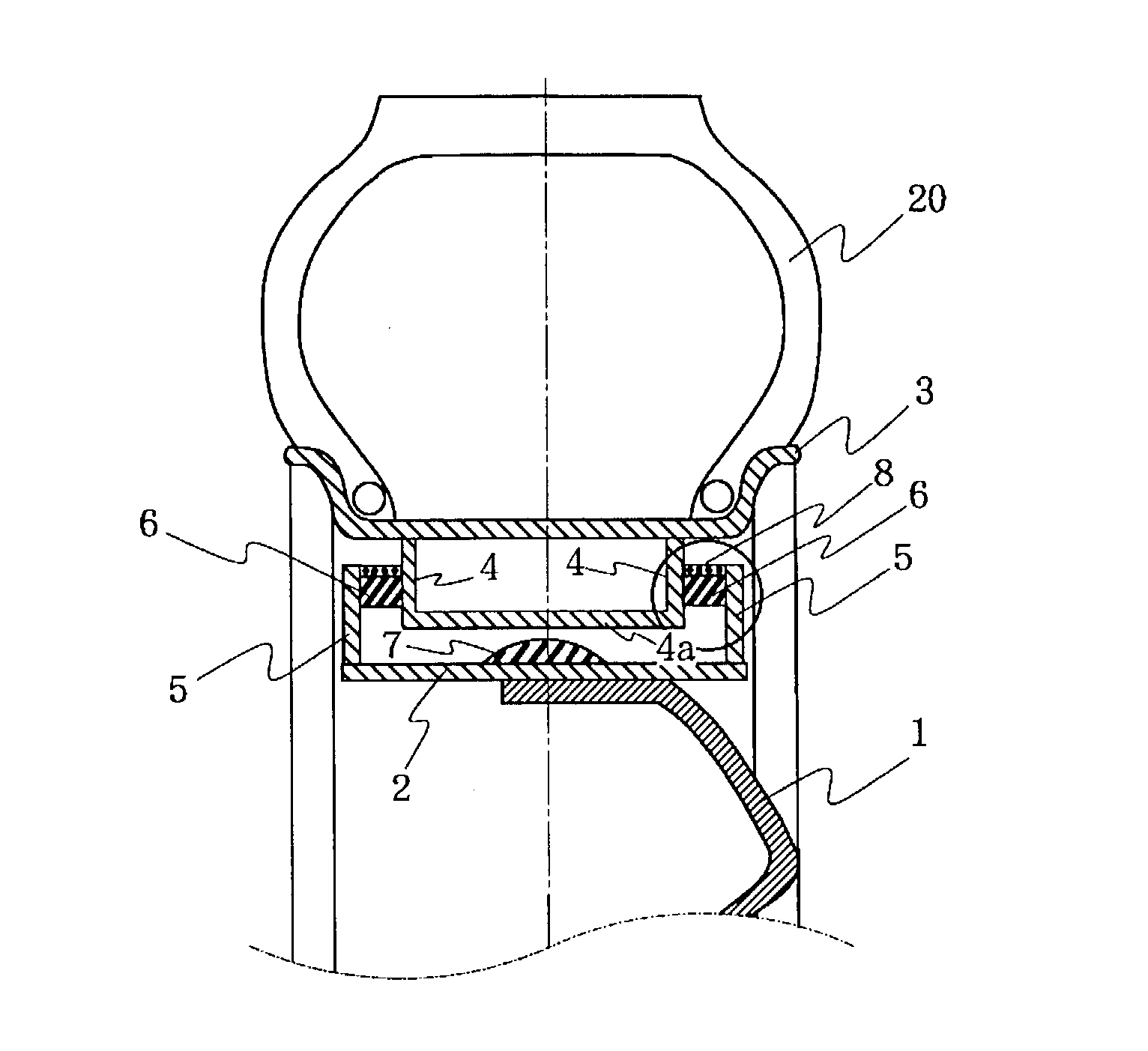

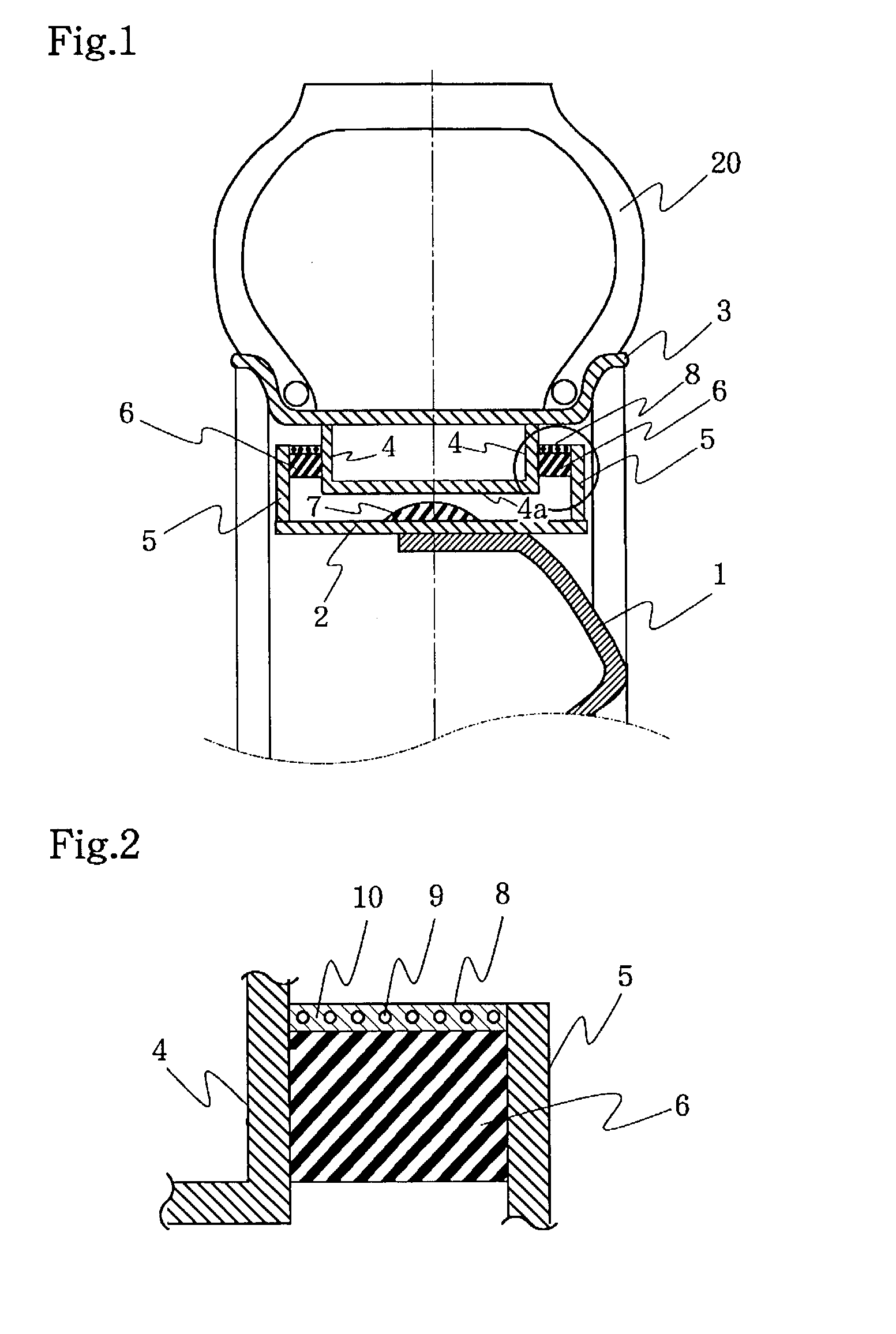

Elastic wheel

InactiveUS20030141642A1Raise the ratioUneven portionLeaf springsResilient suspensionsElastomerEngineering

An elastic wheel comprising a disk (1), a rim (3) supporting a tire (20), a pair of guides (4) annularly fixed on the inner periphery surface of the rim (3), a pair of walls (5) annularly fixed in two side areas along the wheel axial direction on the outer periphery surface of a base rim (2) disposed on the disk (1) or on the outer periphery surface of the disk (1), and rubber elastic bodies (6) each annularly interposed between the side faces of the guides (4) and the side faces of the walls (5), wherein at least one belt (8) is annularly arranged on each rubber elastic body (6). By virtue of the shear deformation of the installed rubber elastic bodies (6), it is possible to absorb vibration, particularly to improve a riding quality associated with a low input, and to improve a vibration prevention performance, a sound insulation performance and a steering stability. As for sound insulation performance, the elastic wheel is extremely effective for sound insulation in high frequency ranges of 100 Hz or more.

Owner:TOPY INDUSTRIES

Disk drive suspension and manufacturing method therefor

An actuator mounting section includes a plate member including a first plate and a second plate. The first plate is formed with an opening which accommodates an actuator element. The second plate includes a main body portion which overlaps the first plate and supporting portions which support opposite ends of the actuator element. A narrow portion narrower than the first plate is formed at a part of the main body portion of the second plate. A weld seal portion is formed by laser-welding the first plate and the second plate at the narrow portion. Adhesive is provided between the opposite ends of the actuator element and an inner surface of the opening of the first plate.

Owner:NHK SPRING CO LTD

Vehicle-body front structure of vehicle

ActiveUS9327675B2Sufficient energyHigh resistancePedestrian/occupant safety arrangementSuperstructure subunitsEnergy absorptionMechanical engineering

A pair of right-and-left brackets which extend obliquely downward and forward from respective front portions of a pair of right-and-left side frames are provided. A stiffener which extends in a vehicle width direction below a bumper beam is attached to respective front ends of the pair of right-and-left brackets. The stiffener is configured such that its front end portion slants downward and forward and has an open cross section, and its rear end portion thereof has a closed cross section. An obstacle can be prevented from coming in below a vehicle-body front portion, and also the sufficient energy absorption in a collision and the prompt flicking-up of an obstacle can properly achieved.

Owner:MAZDA MOTOR CORP

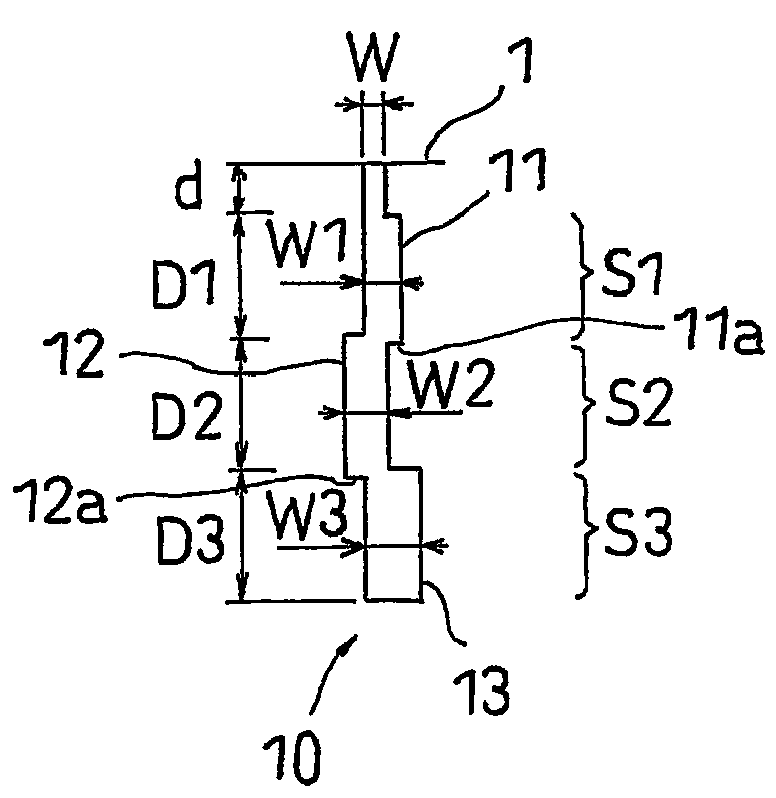

Pneumatic tire with tread having sipe

ActiveUS8544512B2Reduce stiffnessNone have achieved superiorTyre tread bands/patternsNon-skid devicesEngineeringMechanical engineering

A sipe formed in a block of a tread surface is provided with a first sipe portion having a first wide portion, a second sipe portion having a second wide portion in a different side from the first wide portion in a sipe width direction and positioned close to a sipe bottom portion side of the first sipe portion so as to become wider than the first sipe portion, and a third sipe portion having a third wide portion in the same side as the first wide portion in the sipe width direction and positioned close to a sipe bottom portion side of the second sipe portion so as to become wider than the second sipe portion.

Owner:TOYO TIRE & RUBBER CO LTD

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com