Patents

Literature

100results about How to "Simple to implement" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

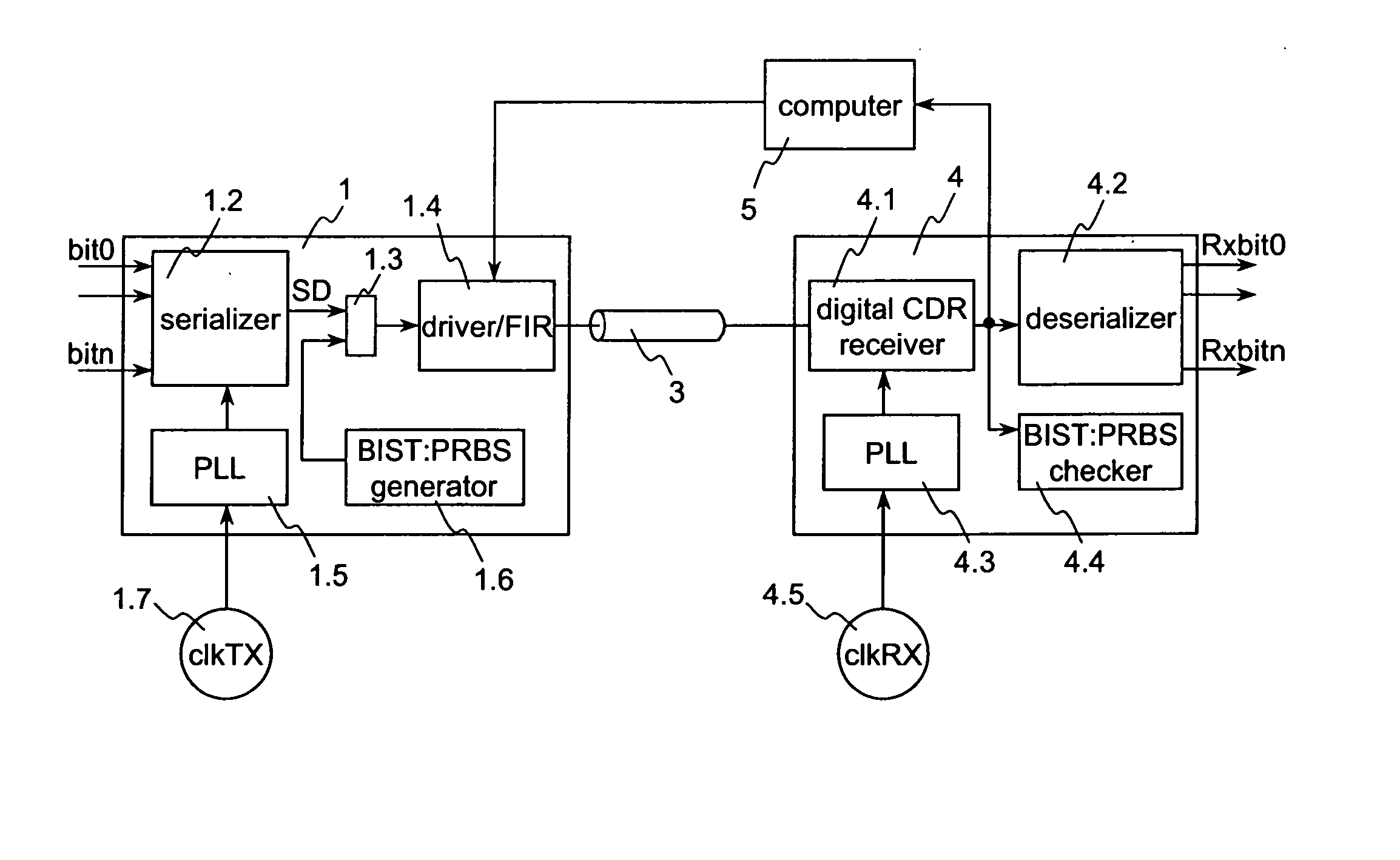

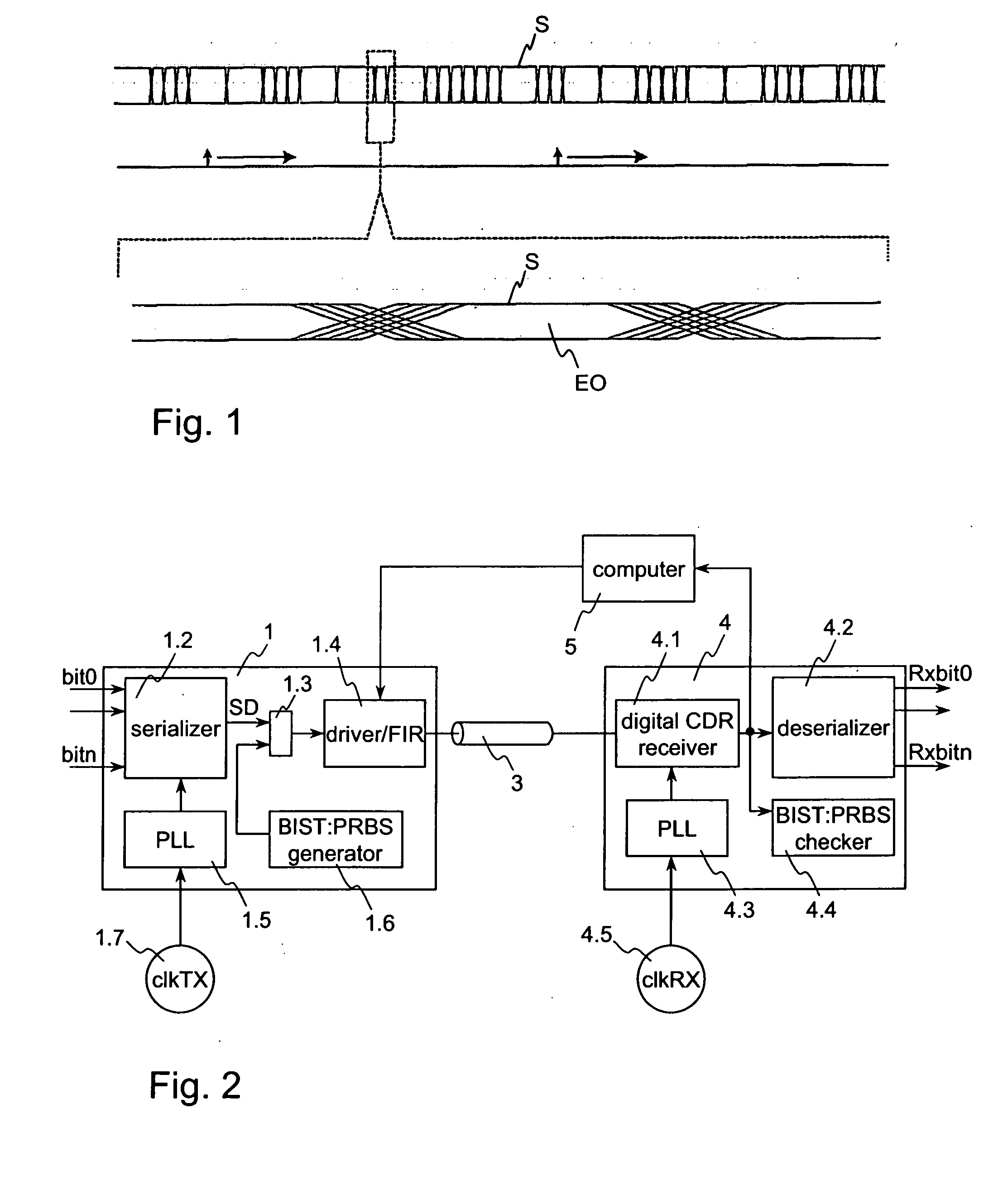

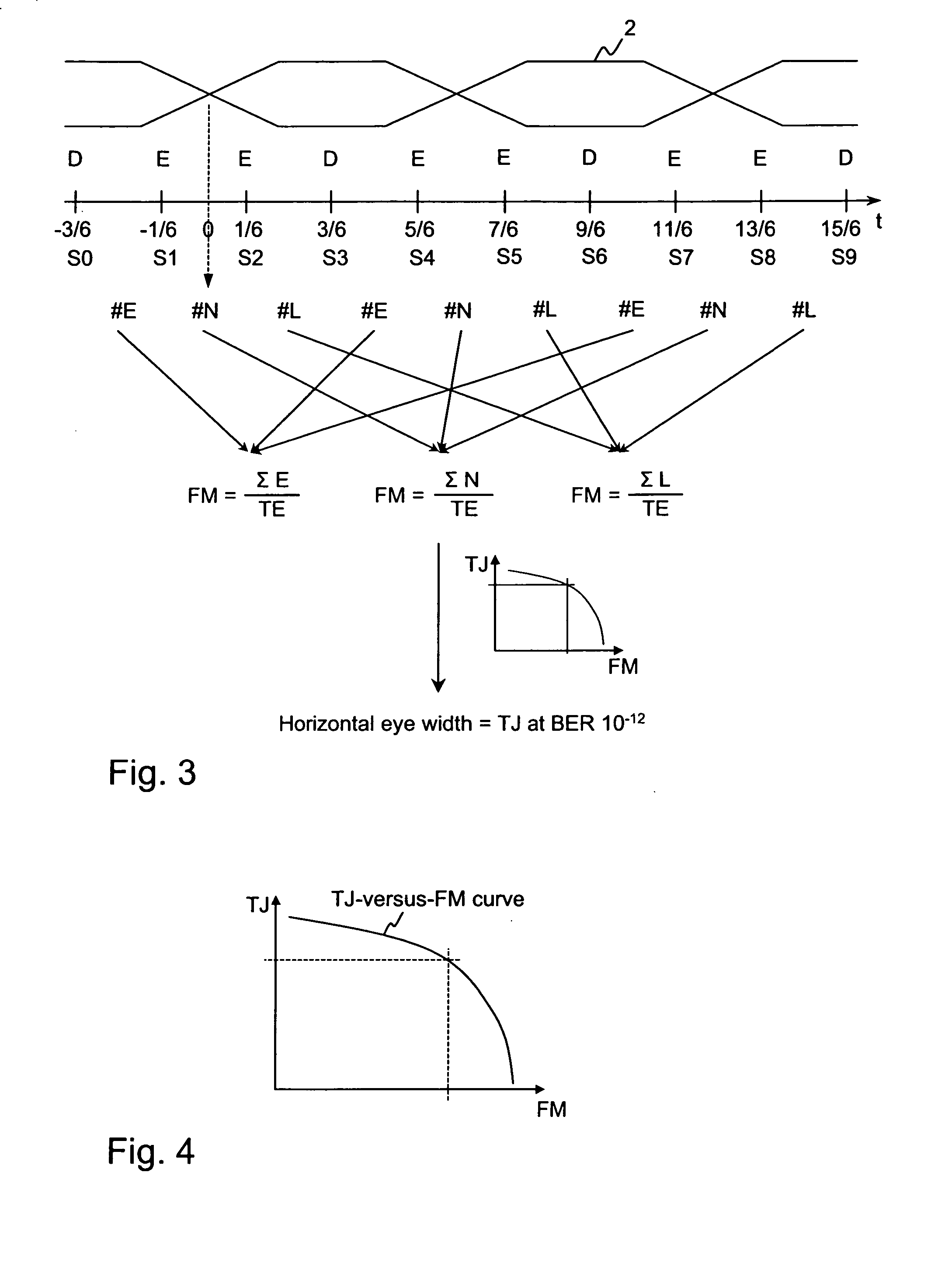

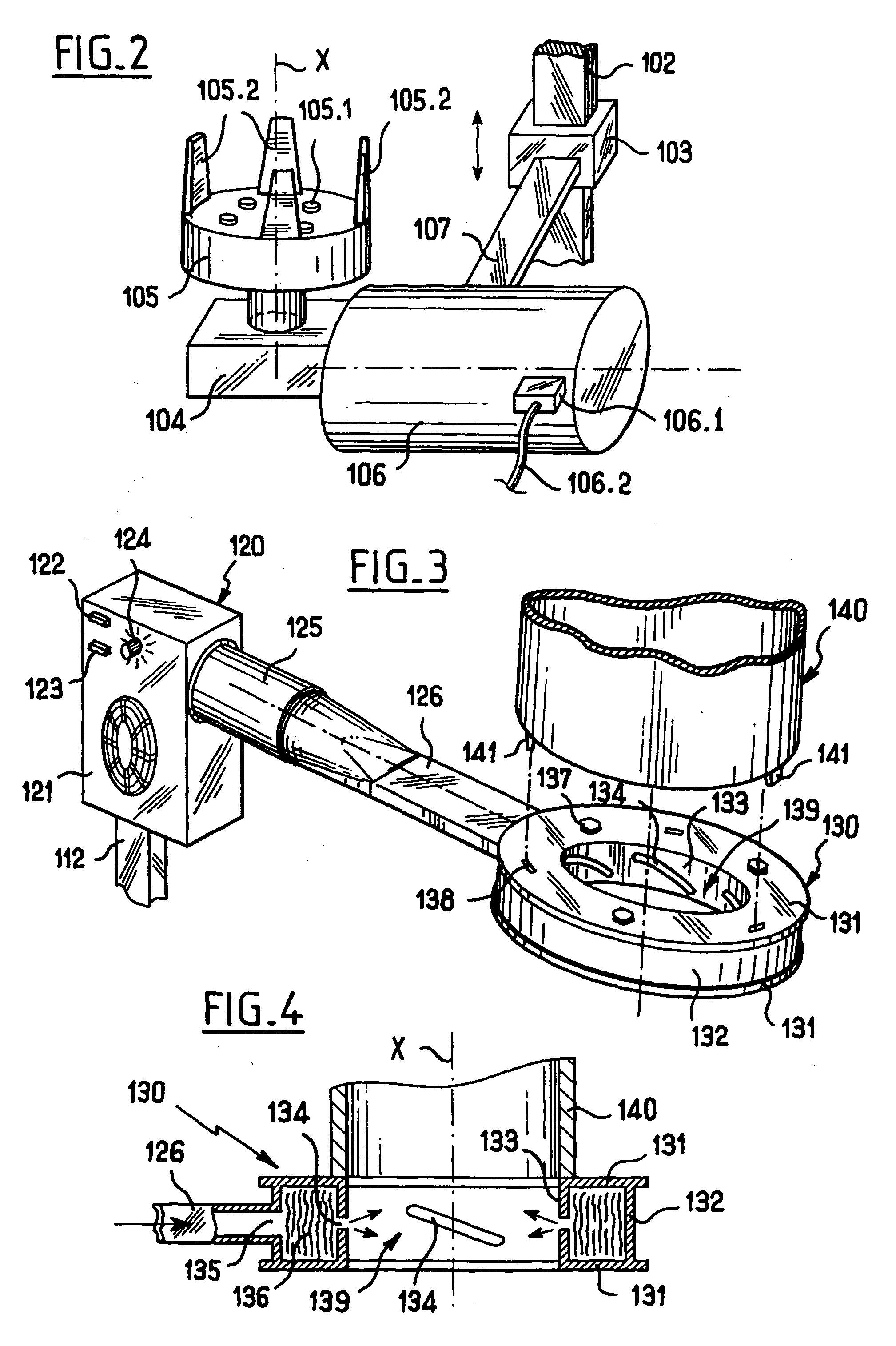

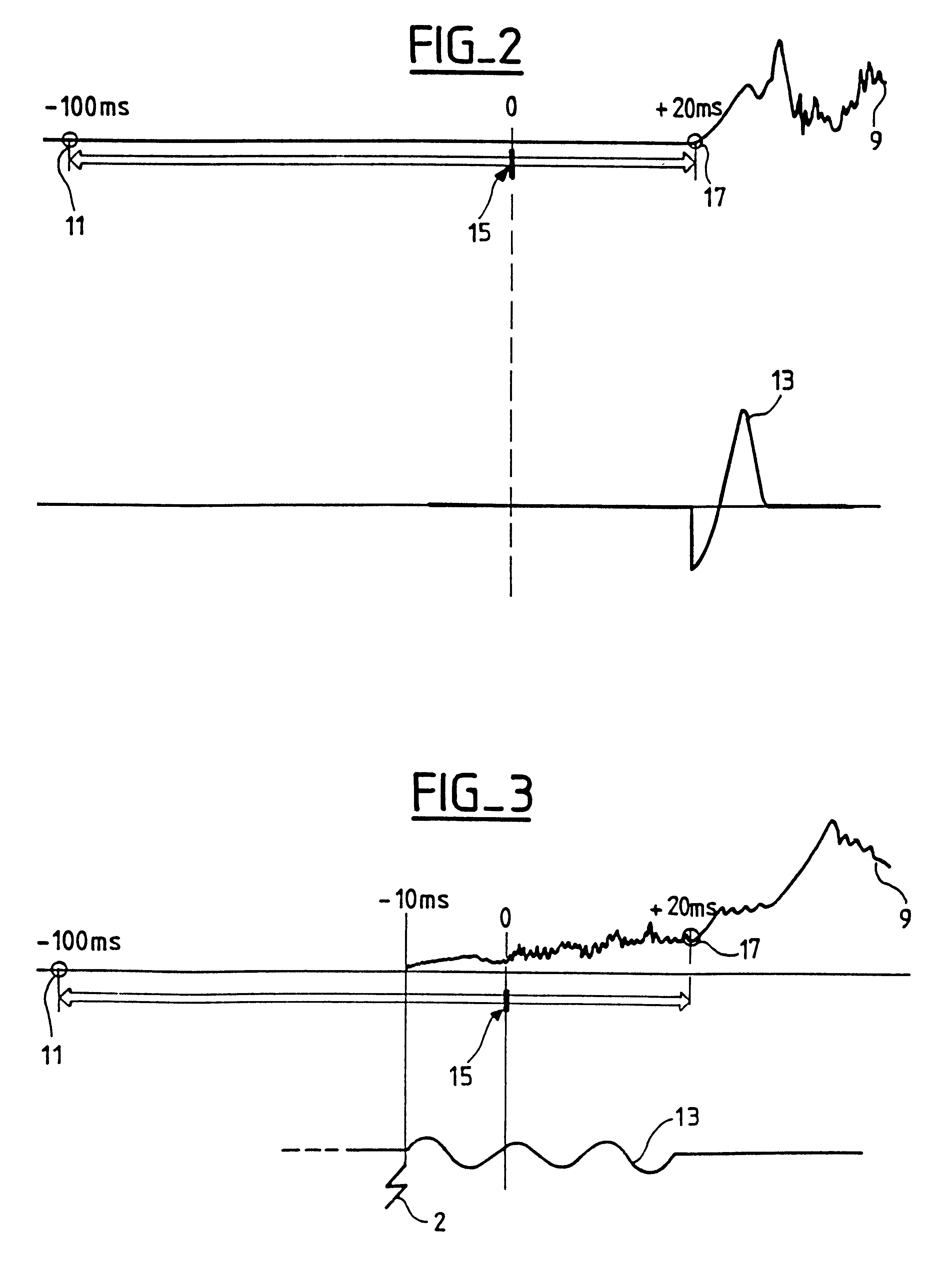

Method for determining jitter of a signal in a serial link and high speed serial link

ActiveUS20050111536A1Simple to implementEasy to implementError detection/prevention using signal quality detectorNoise figure or signal-to-noise ratio measurementHigh speed serial linkFigure of merit

The method for determining jitter of a signal in a serial link according to the invention comprising the following steps: First, a section of the signal transmitted via a transmission channel is sampled at different sampling times. The total number of edges in the section is determined. The neighboring sample values are analyzed and from that a statistical value is formed. From the statistical value and the total number of edges a figure of merit is determined. Finally, by means of a look-up table or a jitter-versus-figure of merit curve, the total jitter corresponding to the figure of merit is derived.

Owner:MARVELL ASIA PTE LTD

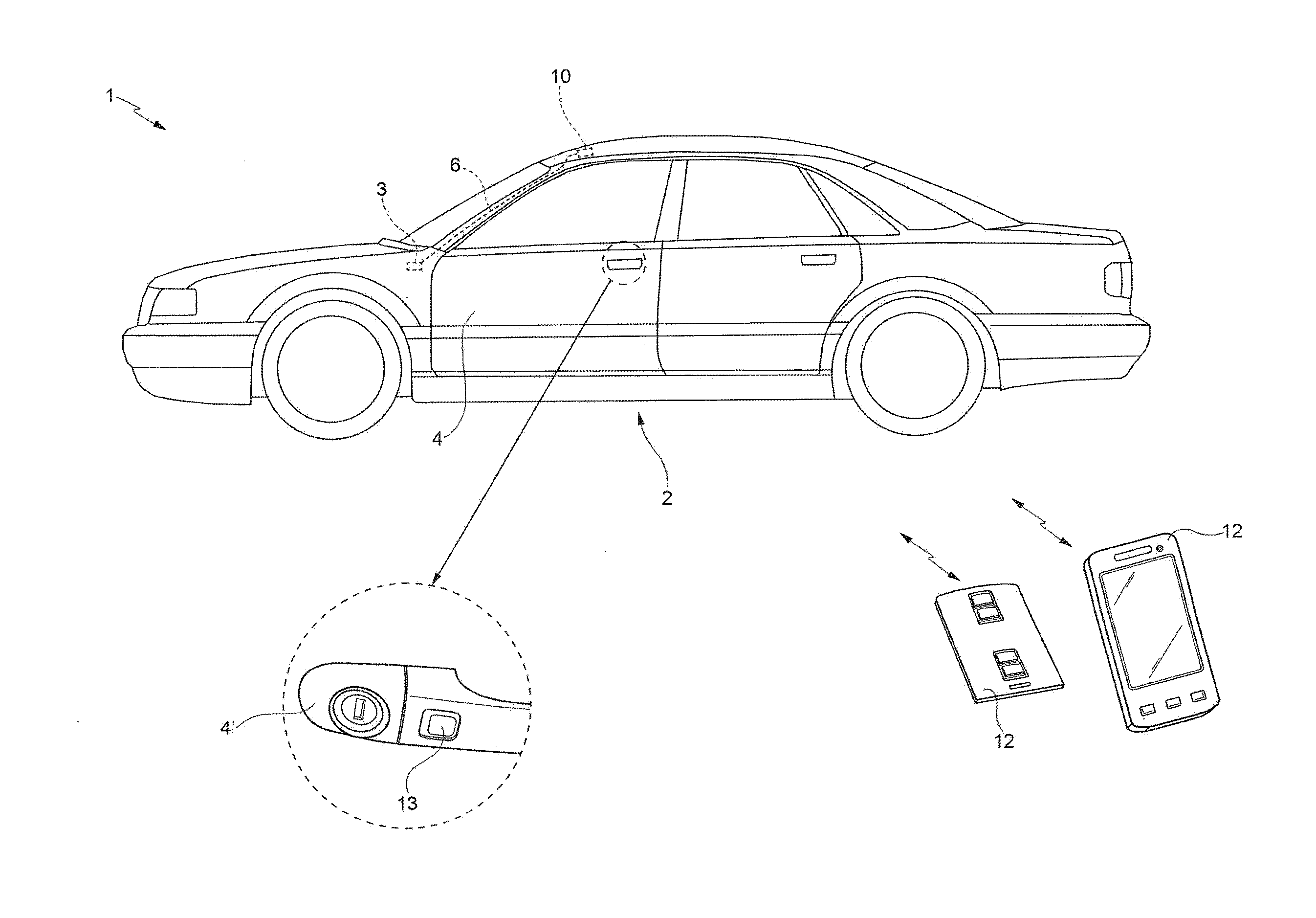

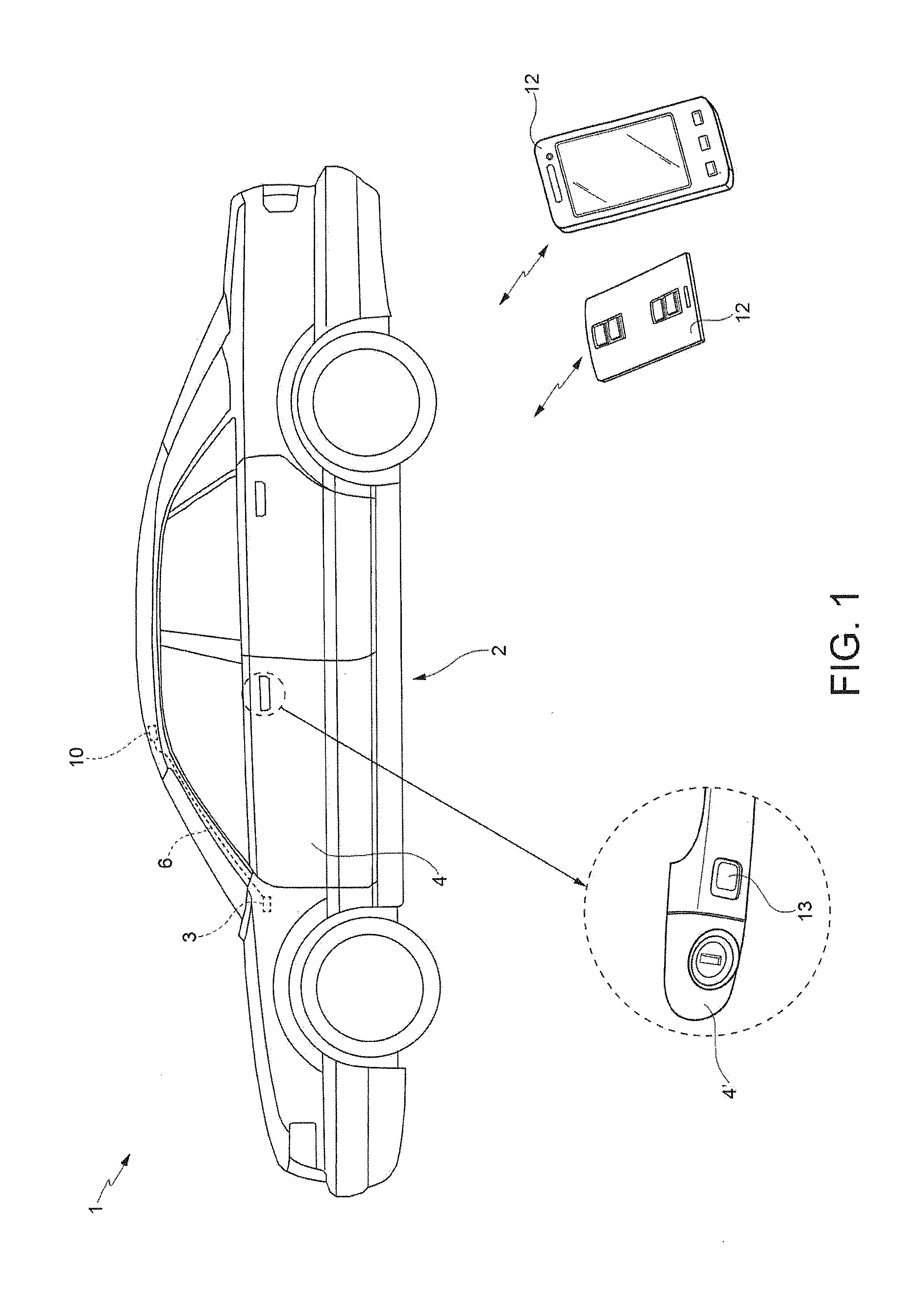

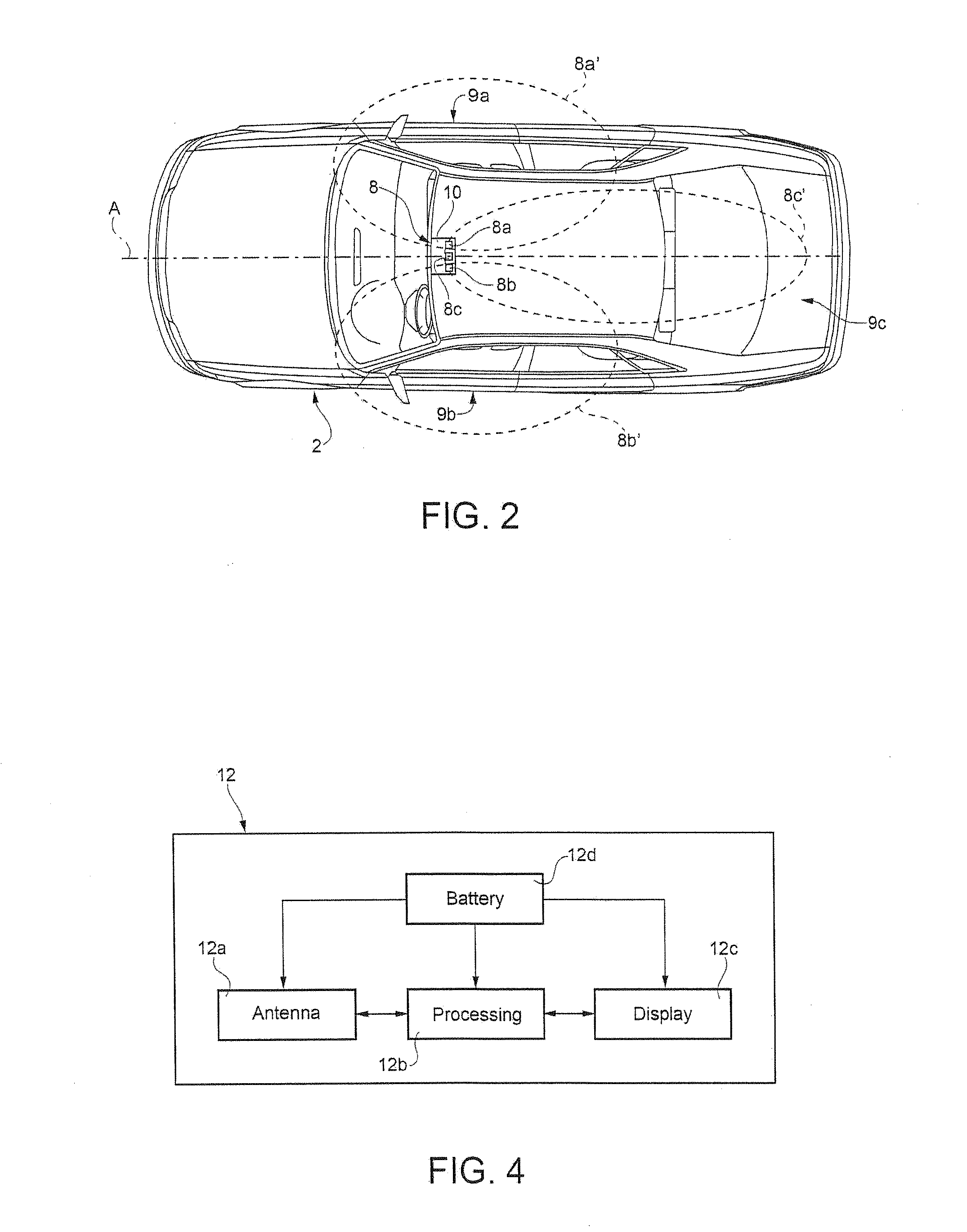

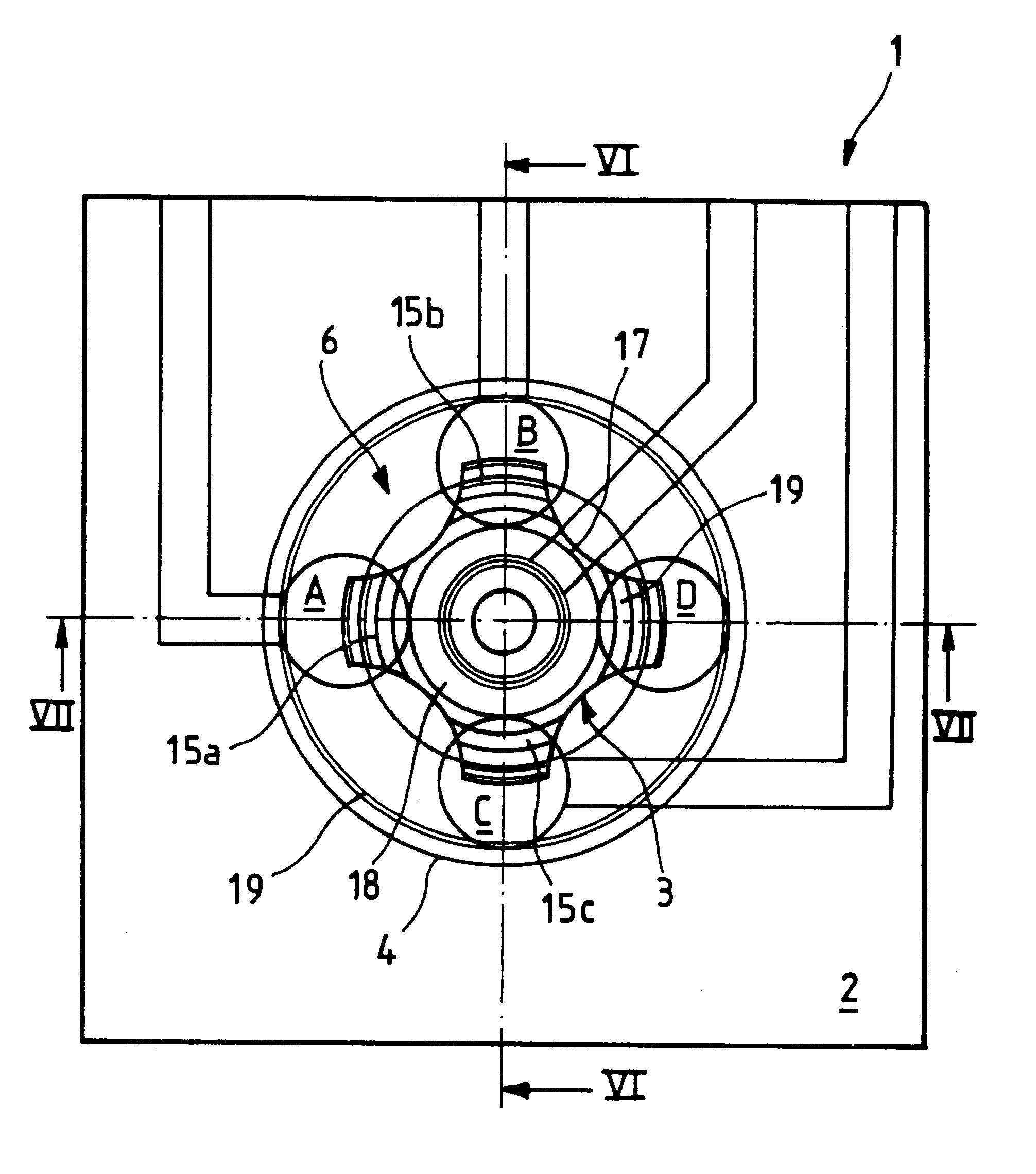

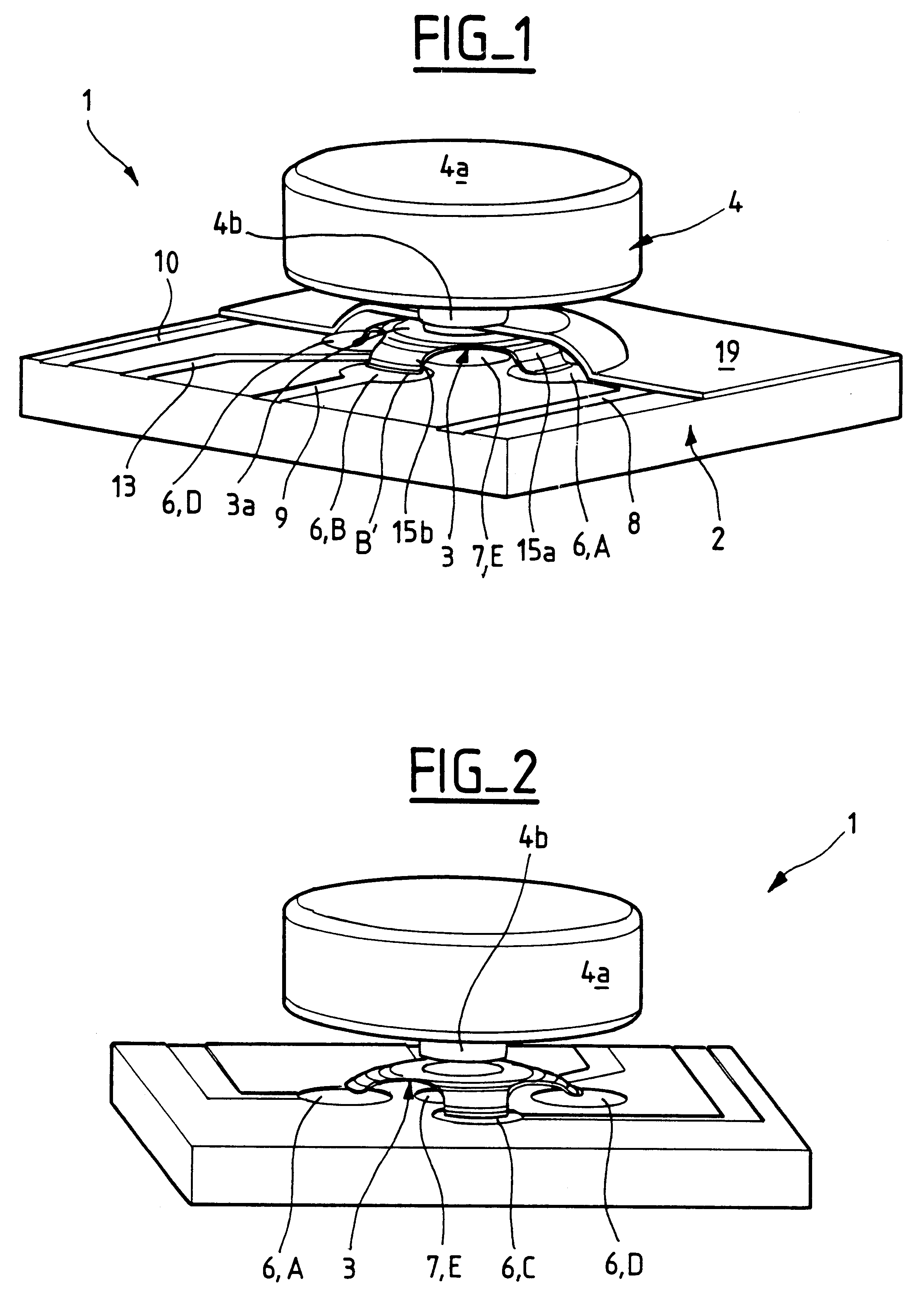

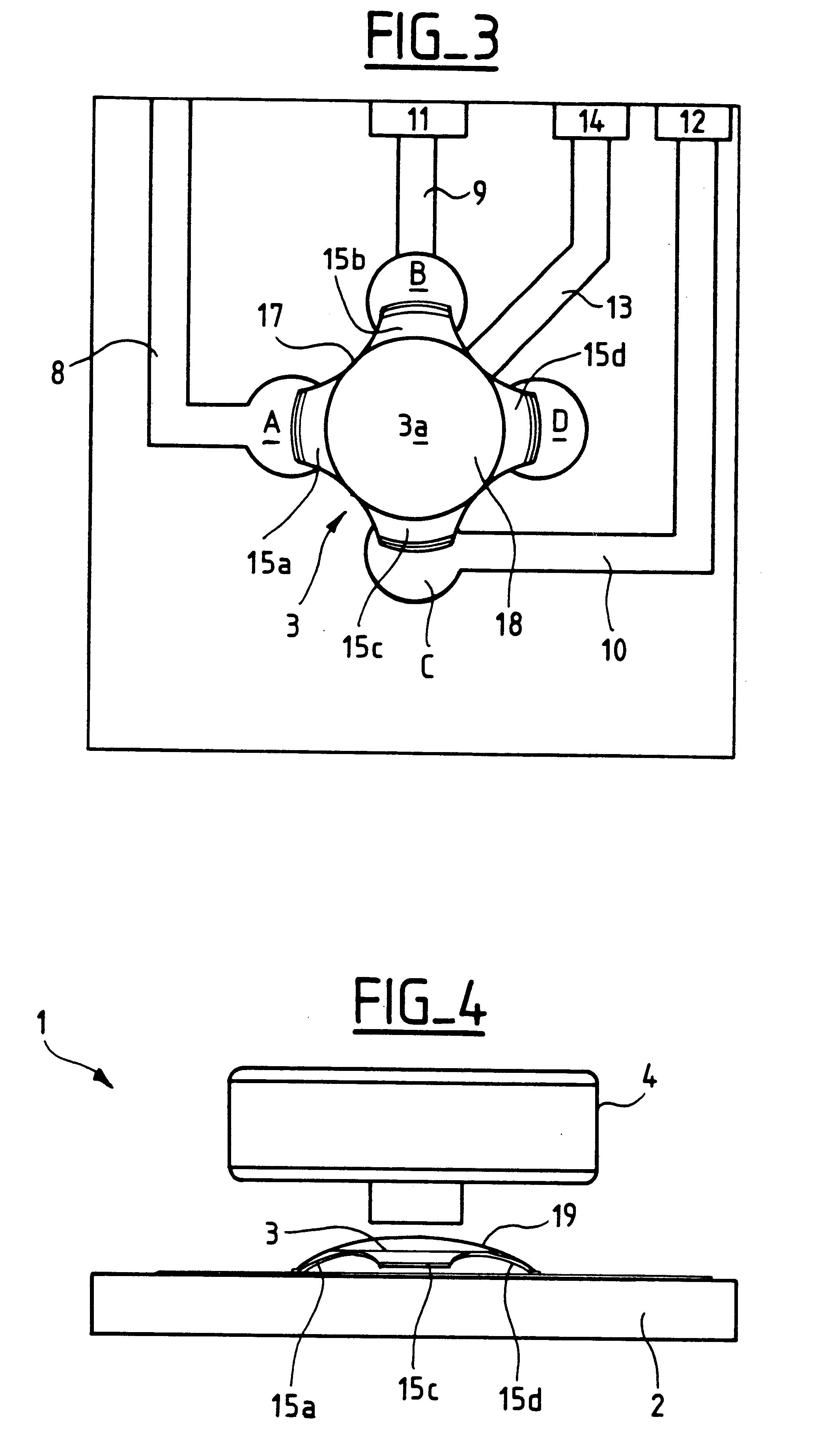

System for passive entry and passive start for a motor vehicle

ActiveUS20140188309A1Simple to implementEasy to implementDigital data processing detailsAnti-theft devicesElectronic control unitRadiation

A system for passive entry and / or passive start for a motor vehicle is described, which includes an antenna group and an electronic control unit designed to be coupled to the vehicle, the electronic control unit for controlling the antenna group to cooperate with a portable recognition device carried by a user to enable the entry and / or start of the vehicle. The antenna group has at least a first antenna and a second antenna, designed to operate within the frequency range, and according to the communication protocol, of the Bluetooth standard, and having a respective radiation lobe; wherein the first antenna and the second antenna are arranged so that their radiation lobes are arranged on opposite sides with respect to a longitudinal symmetry axis of the motor vehicle.

Owner:TRW AUTOMOTIVE ITAL

Efficient certificate revocation

InactiveUS7337315B2Simple to implementLow costPublic key for secure communicationUser identity/authority verificationRevocationTree based

A method and system for overcoming the problems associated with certificate revocation lists (CRL's), for example, in a public key infrastructure. The invention uses a tree-based scheme to replace the CRL.

Owner:ASSA ABLOY AB

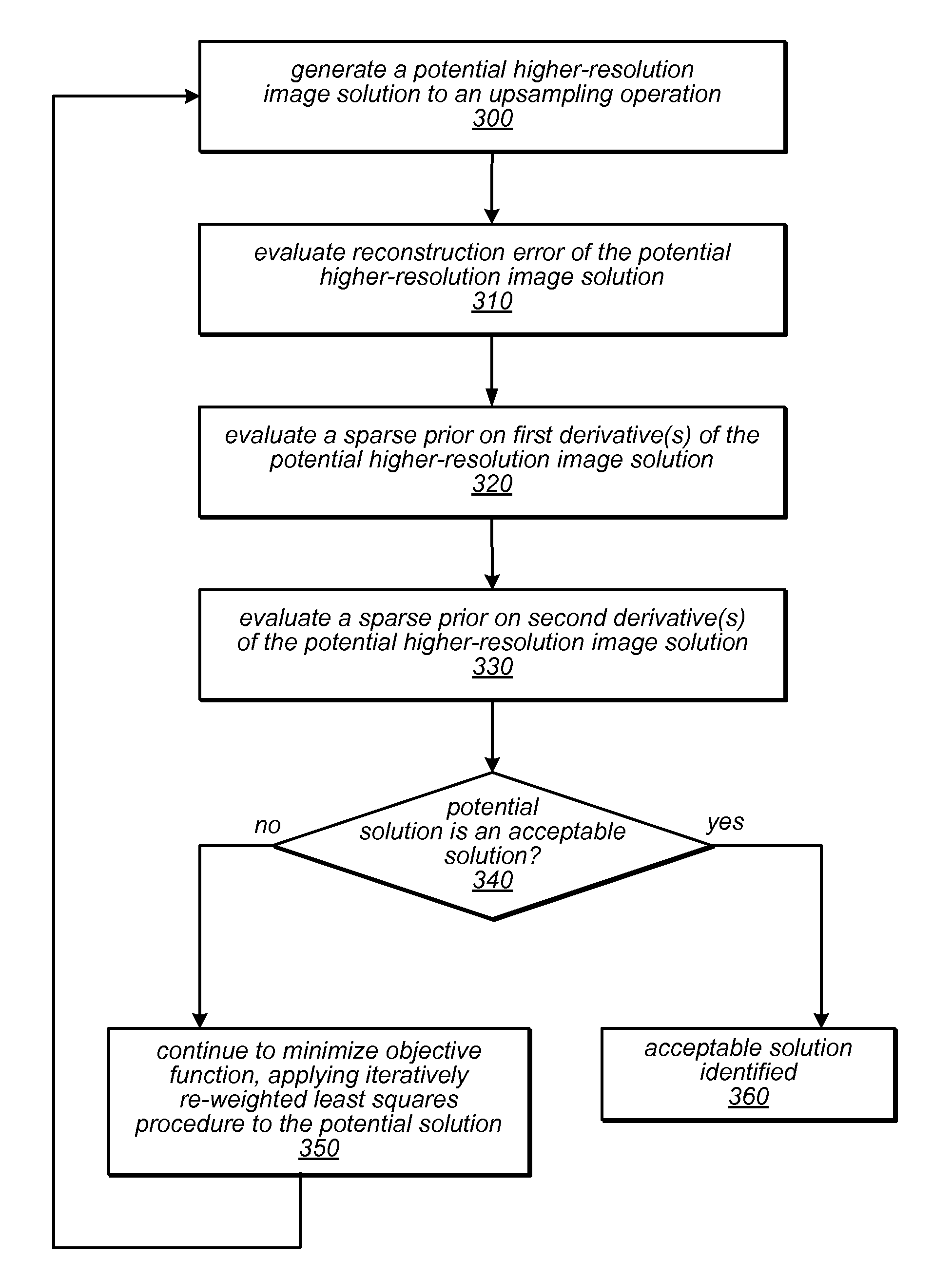

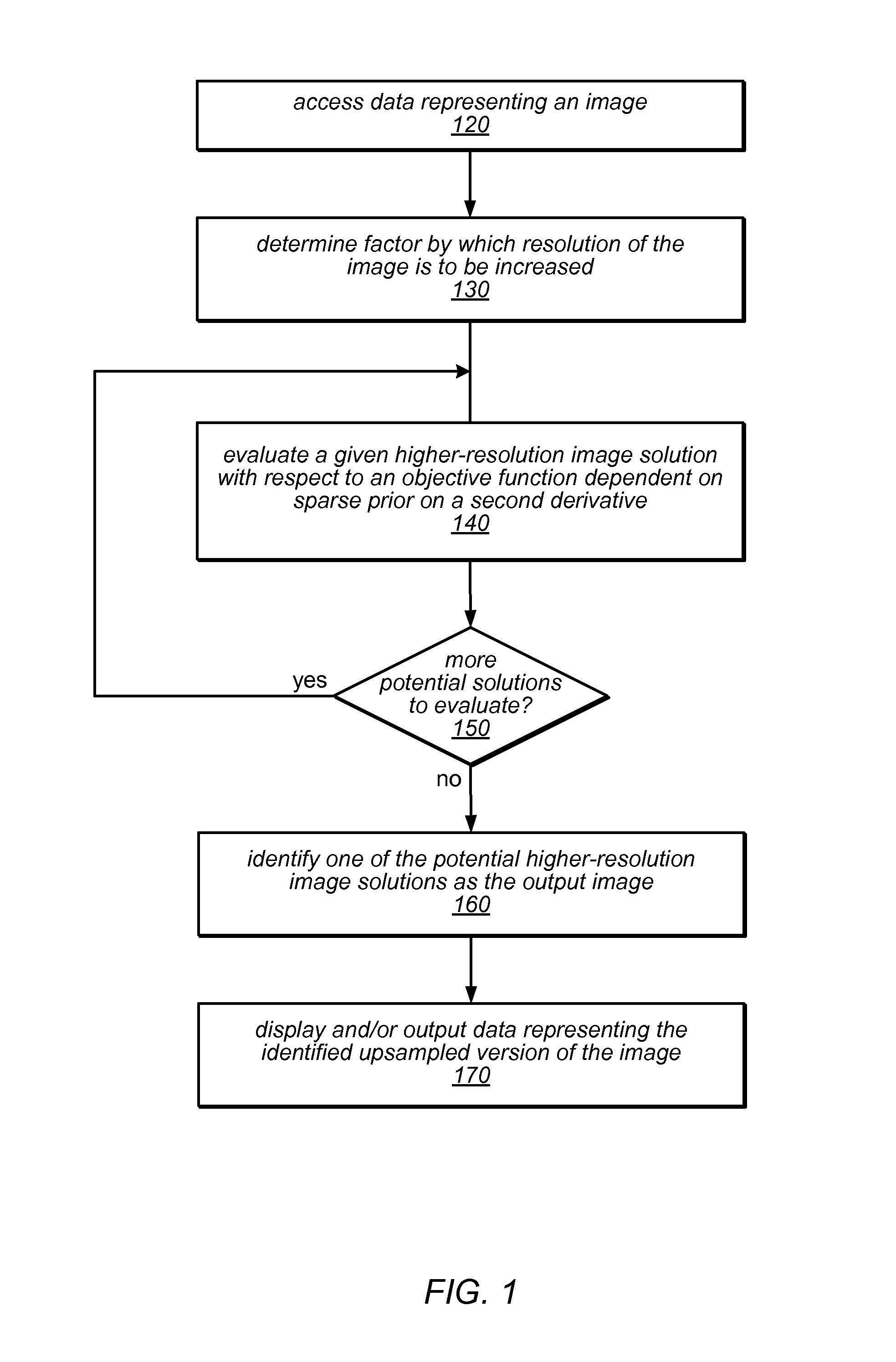

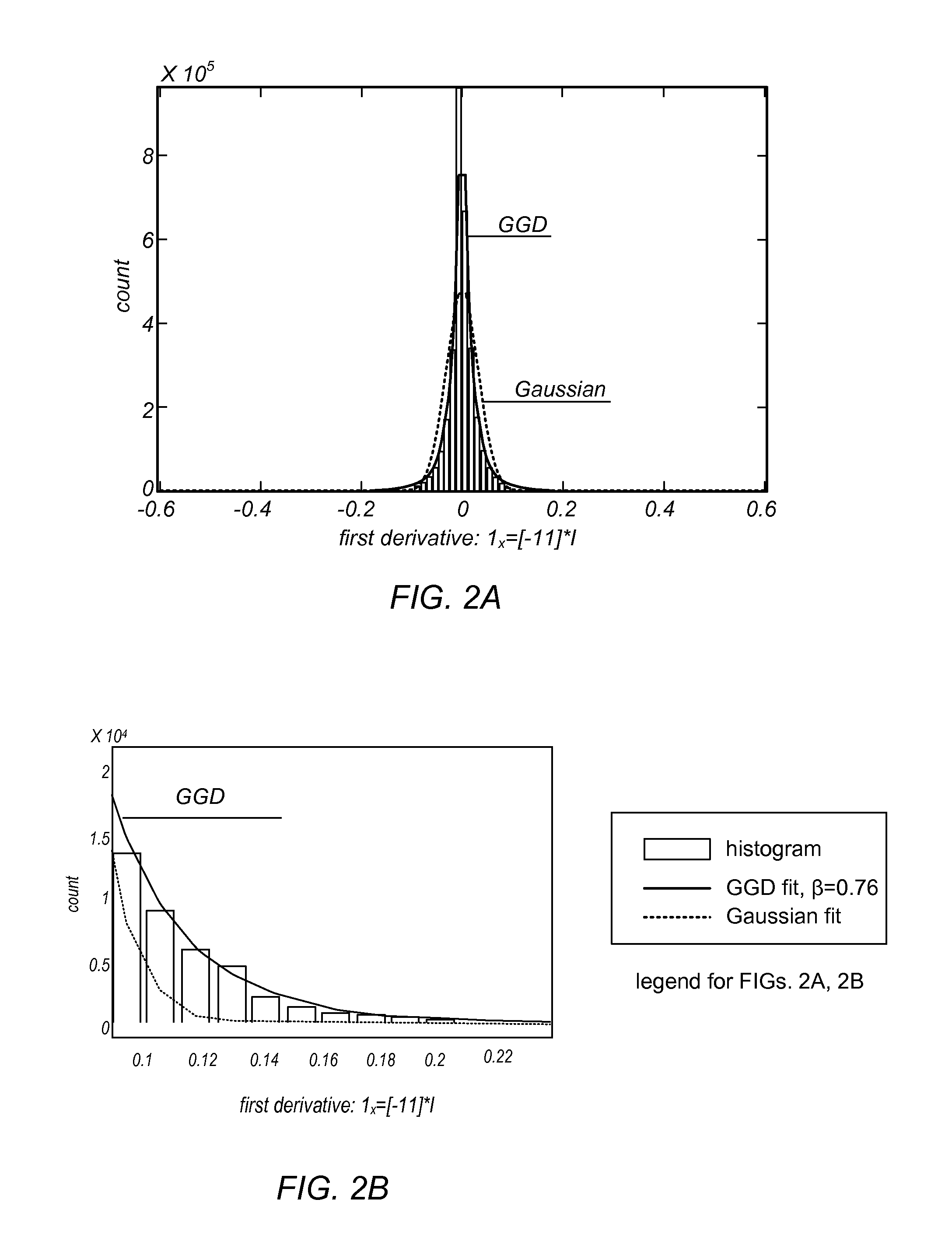

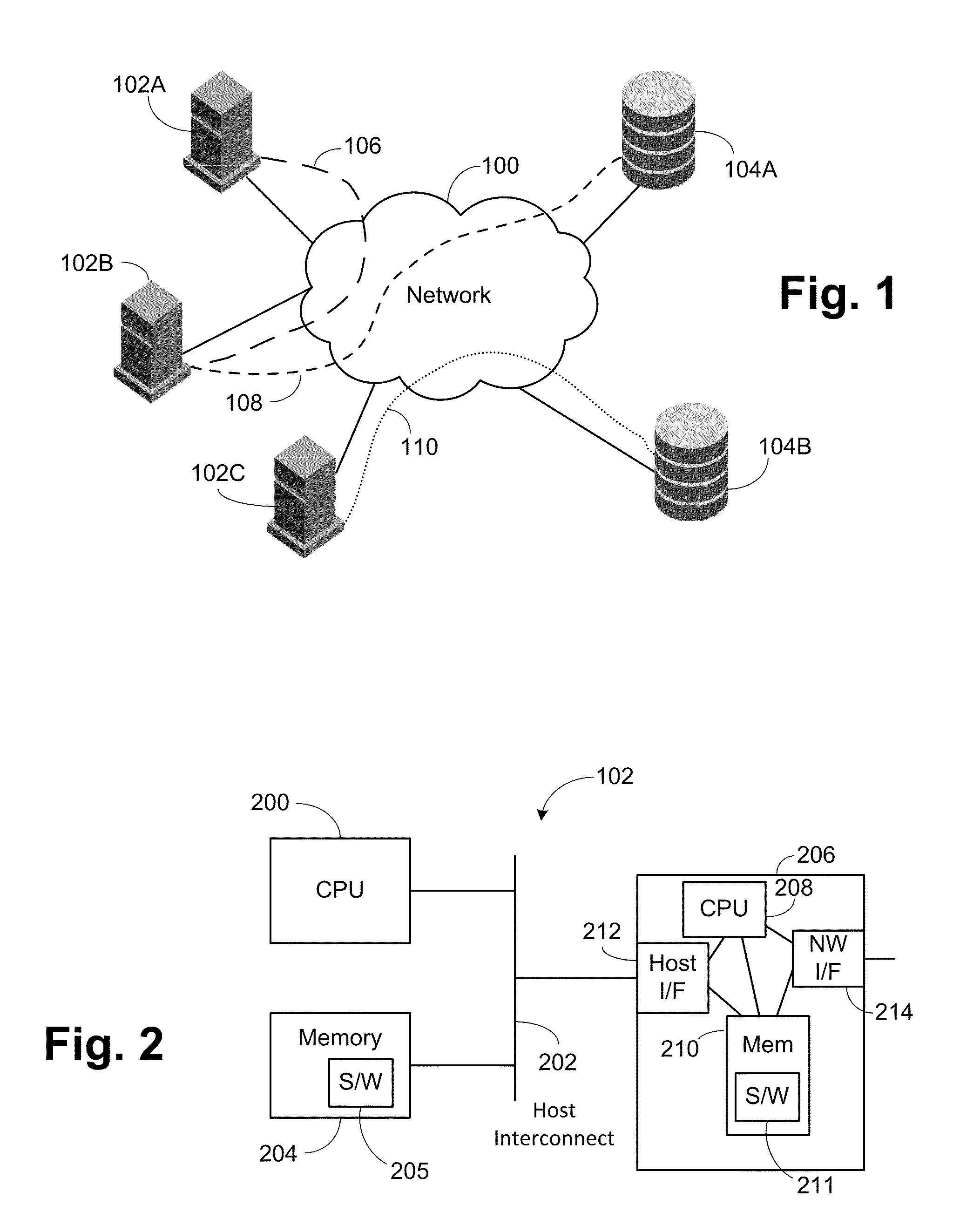

System and method for image upsampling using natural image statistics of first and second derivatives

ActiveUS8369653B1Simple and efficient to implementEfficient to implementGeometric image transformationCharacter and pattern recognitionGraphicsProgram instruction

Systems and methods for upsampling input images may evaluate potential upsampling solutions with respect to an objective function that is dependent on a sparse derivative prior on second derivative(s) of the potential upsampling solutions to identify an acceptable higher-resolution output image. The objective function may also be dependent on fidelity term(s) and / or sparse derivative prior(s) on first derivative(s) of potential upsampling solutions. The methods may include applying the iteratively re-weighted least squares procedure in minimizing the objective function and generating improved candidate solutions from an initial solution. The identified solution may be stored as a higher-resolution version of the input image in memory, and made available to subsequent operations in an image editing application or other graphics application. The methods may produce sharp results that are also smooth along edges. The methods may be implemented as program instructions stored on computer-readable storage media, executable by a CPU and / or GPU.

Owner:ADOBE SYST INC

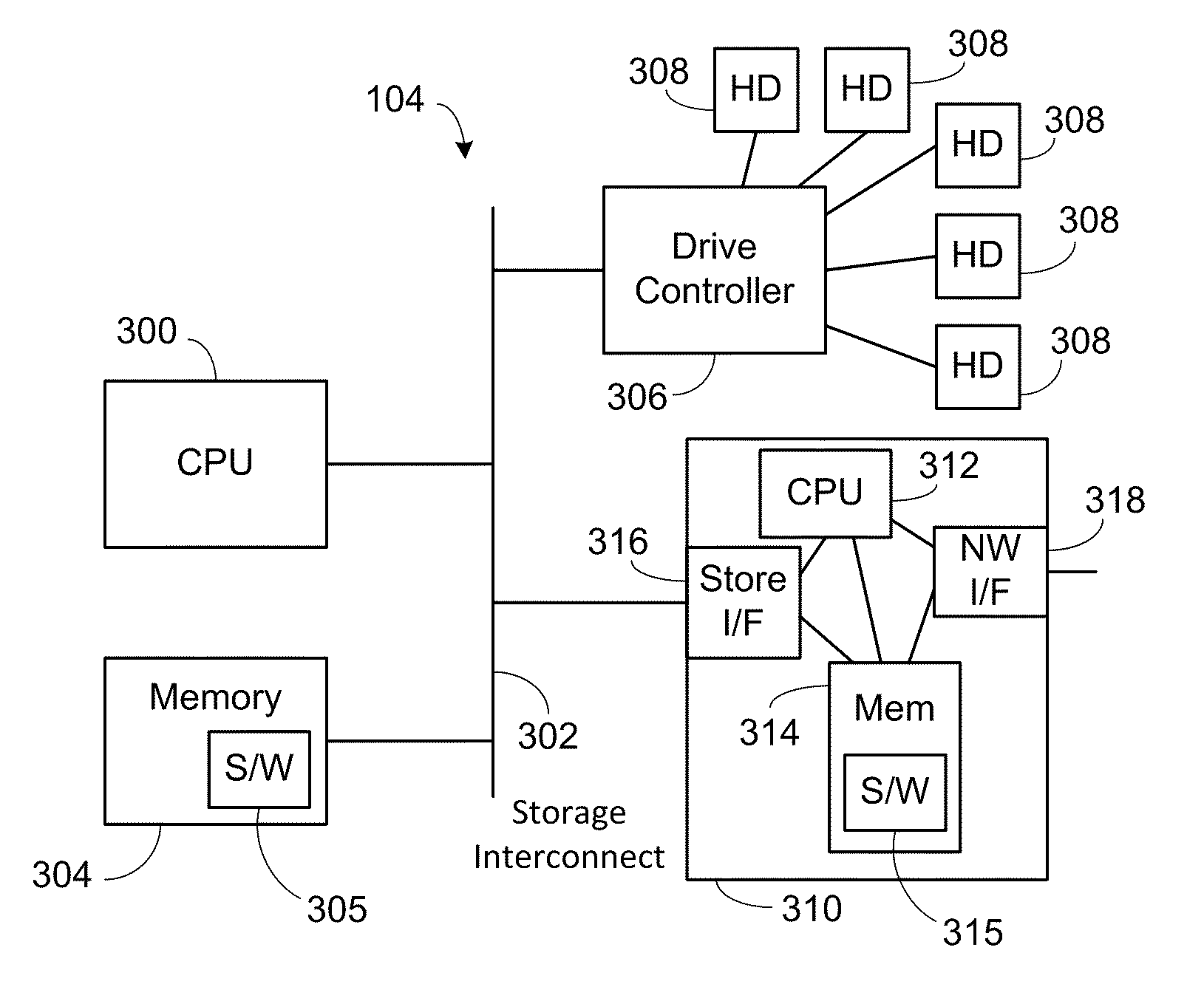

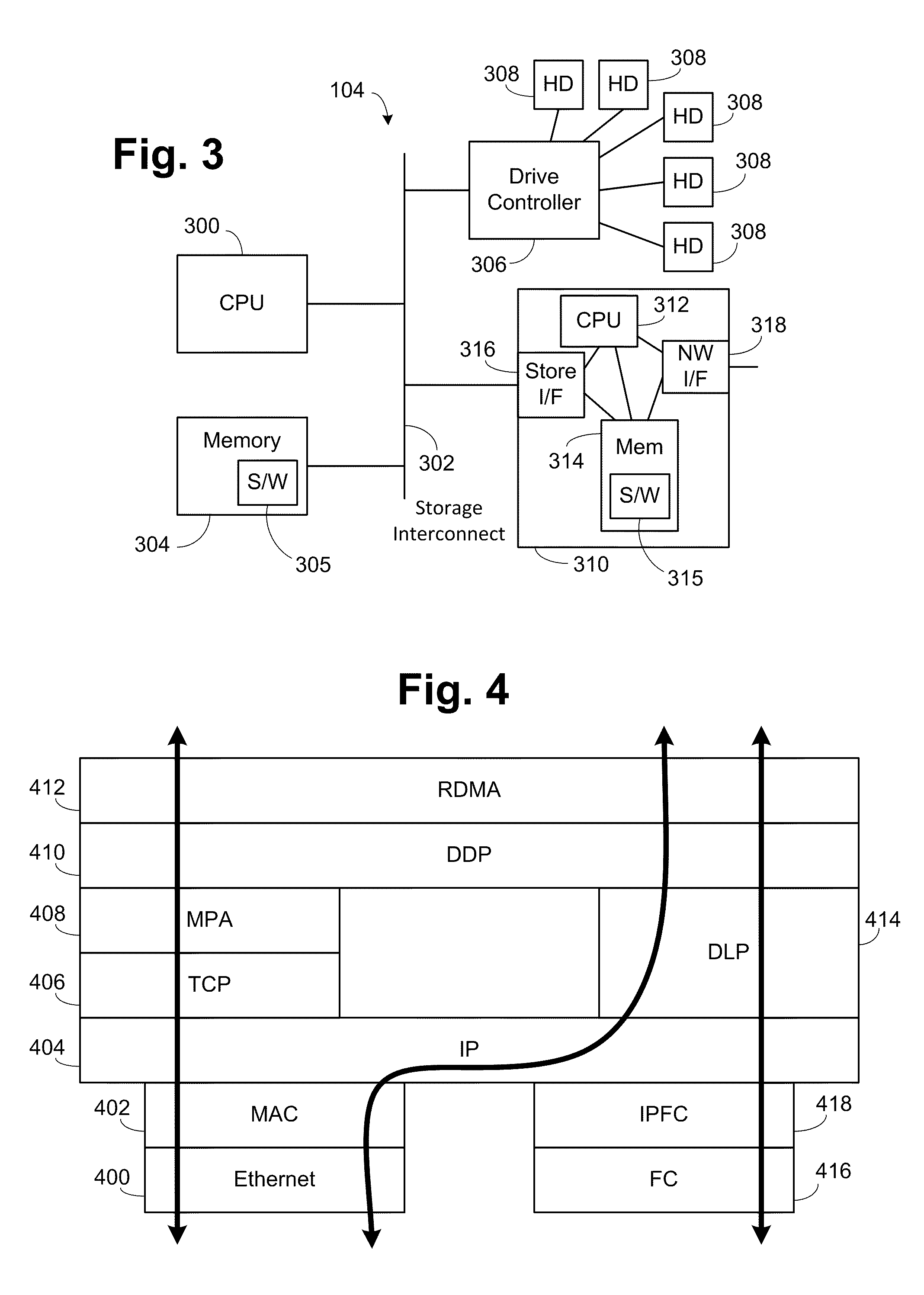

Simplified rdma over ethernet and fibre channel

InactiveUS20100183024A1High performanceSimple to implementError prevention/detection by using return channelData switching detailsIp layerTransmission protocol

A new transport protocol between the IP layer and the DDP layer for use with RDMA operations. The embodiments all operate on a CEE-compliant layer 2 Ethernet network to allow the new transport protocol to be simplified, providing higher performance and simpler implementation. The new protocol allows a CEE-compliant layer 2 Ethernet network to provide data networking using IP, storage using FCoE, and RDMA using IP and the new transport protocol, without suffering the previous performance penalties in any of these aspects.

Owner:BROCADE COMMUNICATIONS SYSTEMS

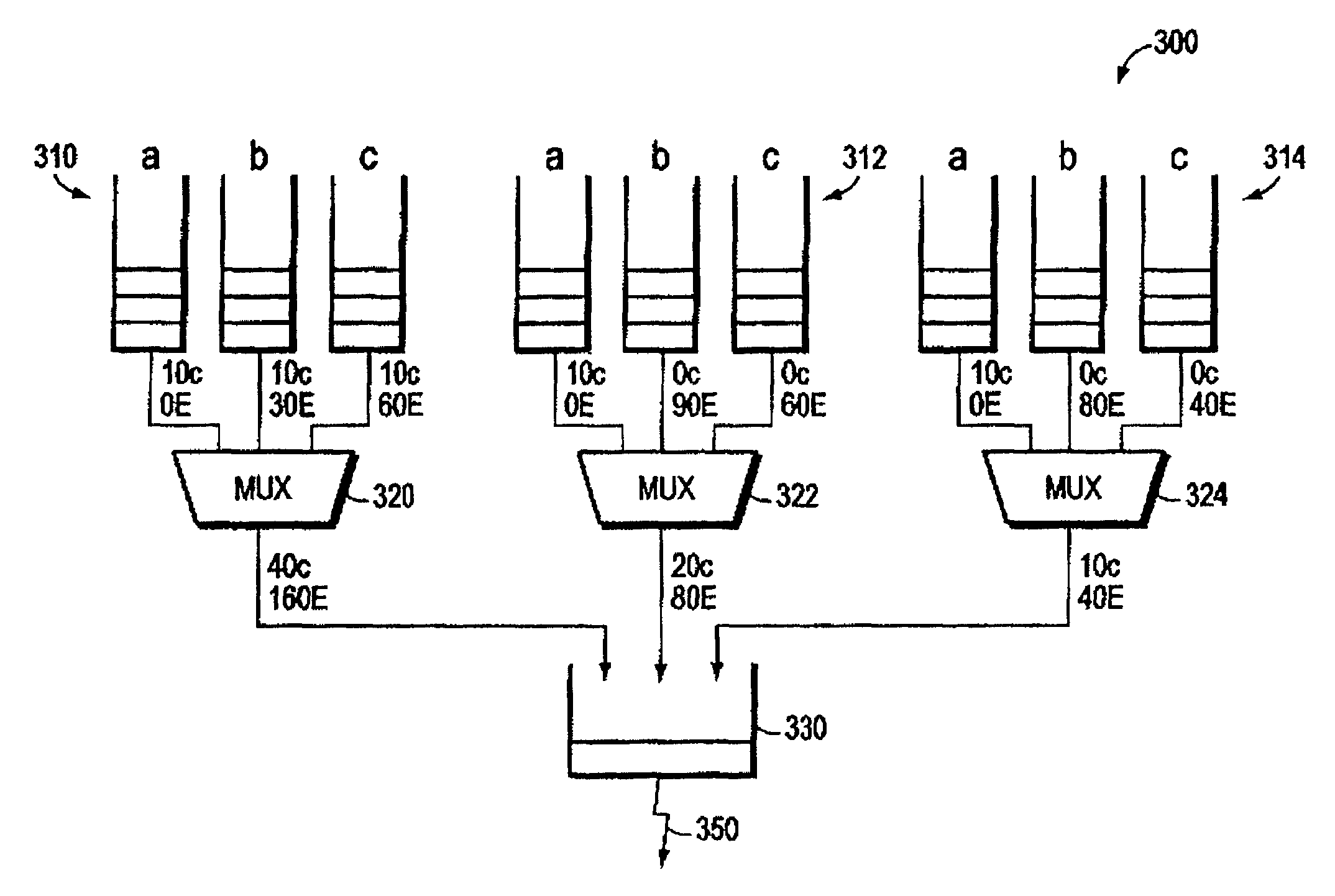

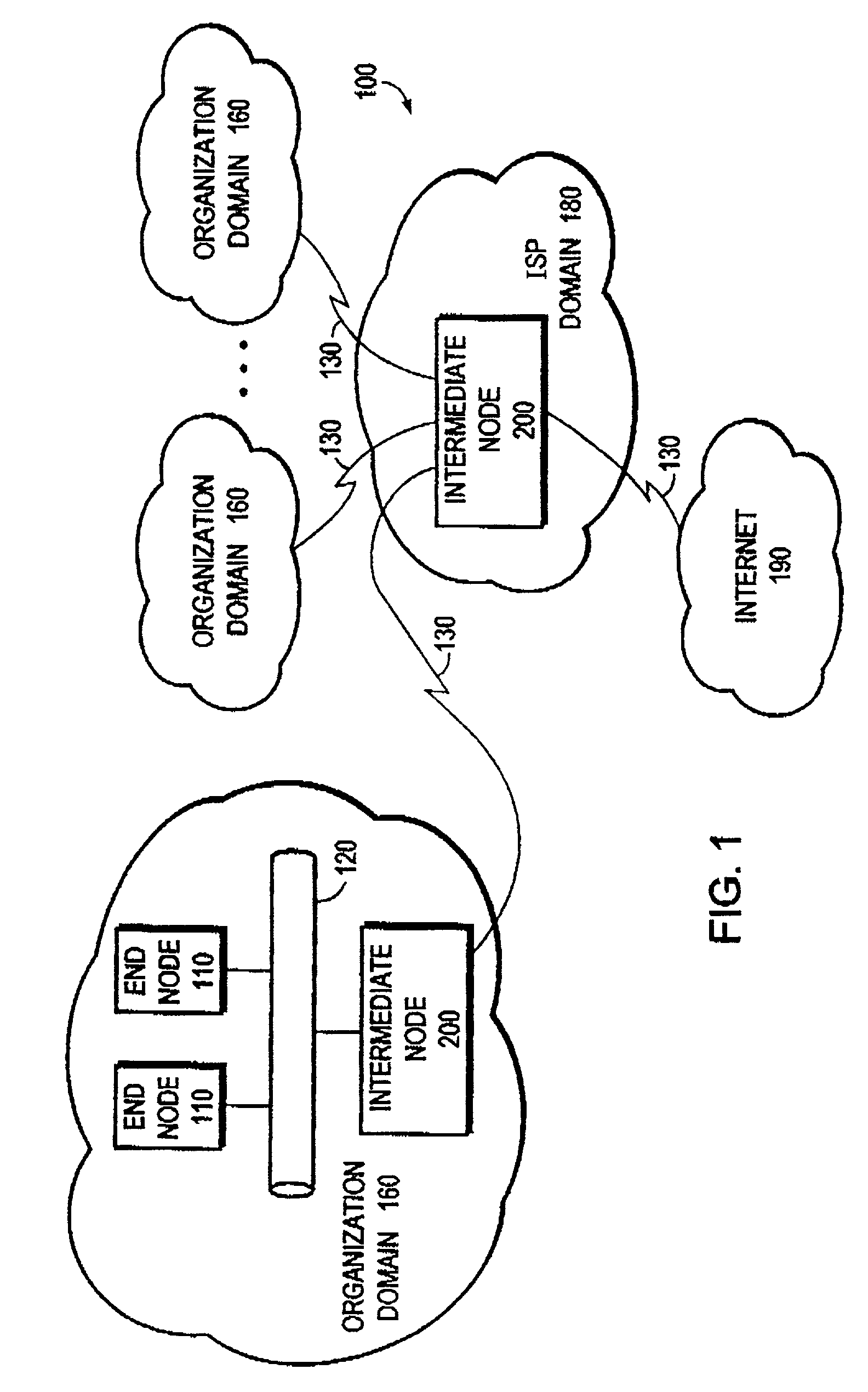

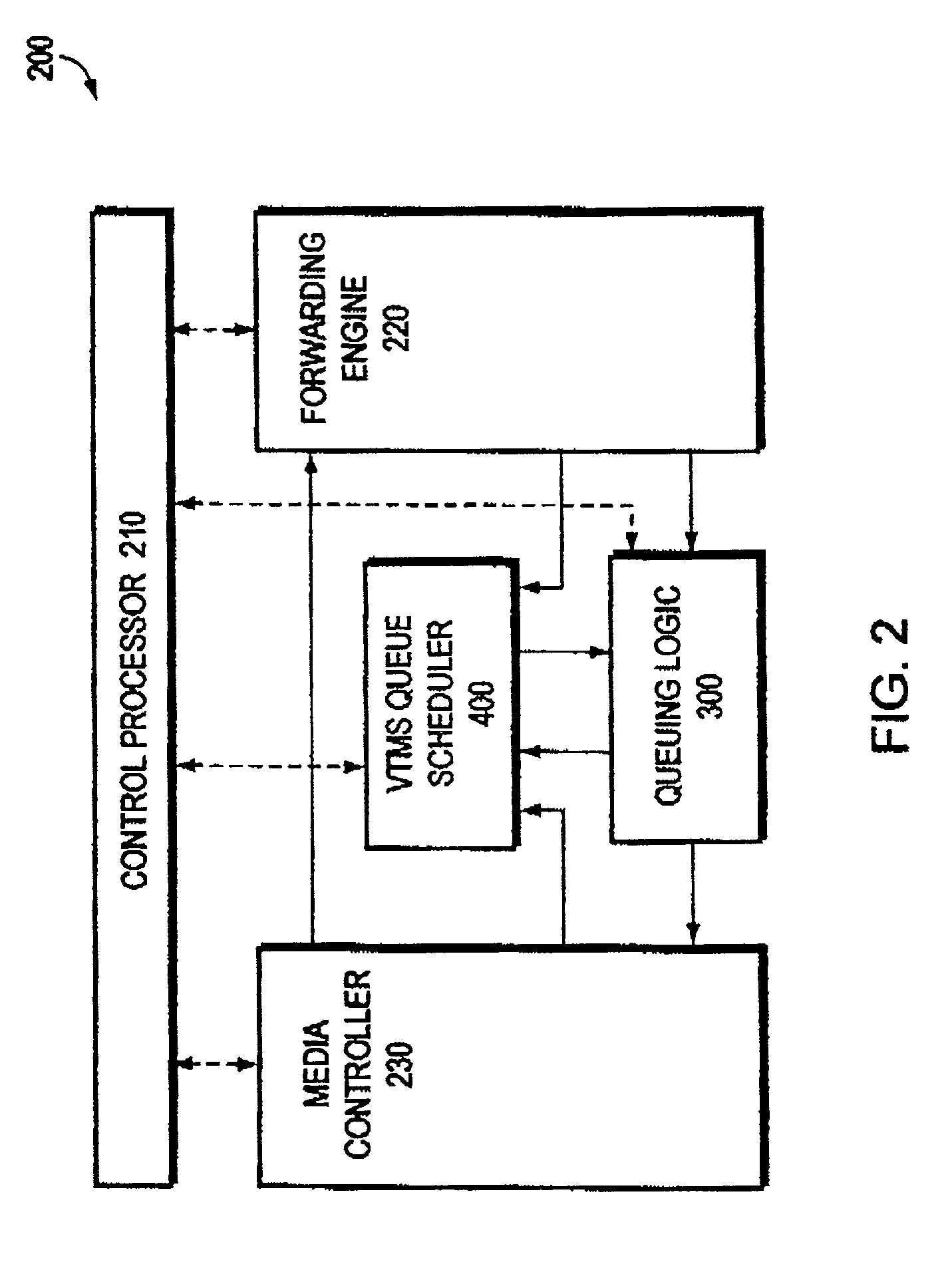

Flexible, high performance support for QoS on an arbitrary number of queues

ActiveUS7292578B1Simple to implementReduce inaccuracyError preventionTransmission systemsTraffic volumeTraffic shaping

A VTMS queue scheduler integrates traffic shaping and link sharing functions within a single mechanism and that scales to an arbitrary number of queues of an intermediate station in a computer network. The scheduler assigns committed information bit rate and excess information bit rate values per queue, along with a shaped maximum bit rate per media link of the station. The integration of shaping and sharing functions decreases latency-induced inaccuracies by eliminating a queue and feedback mechanism between the sharing and shaping functions of conventional systems.

Owner:CISCO TECH INC

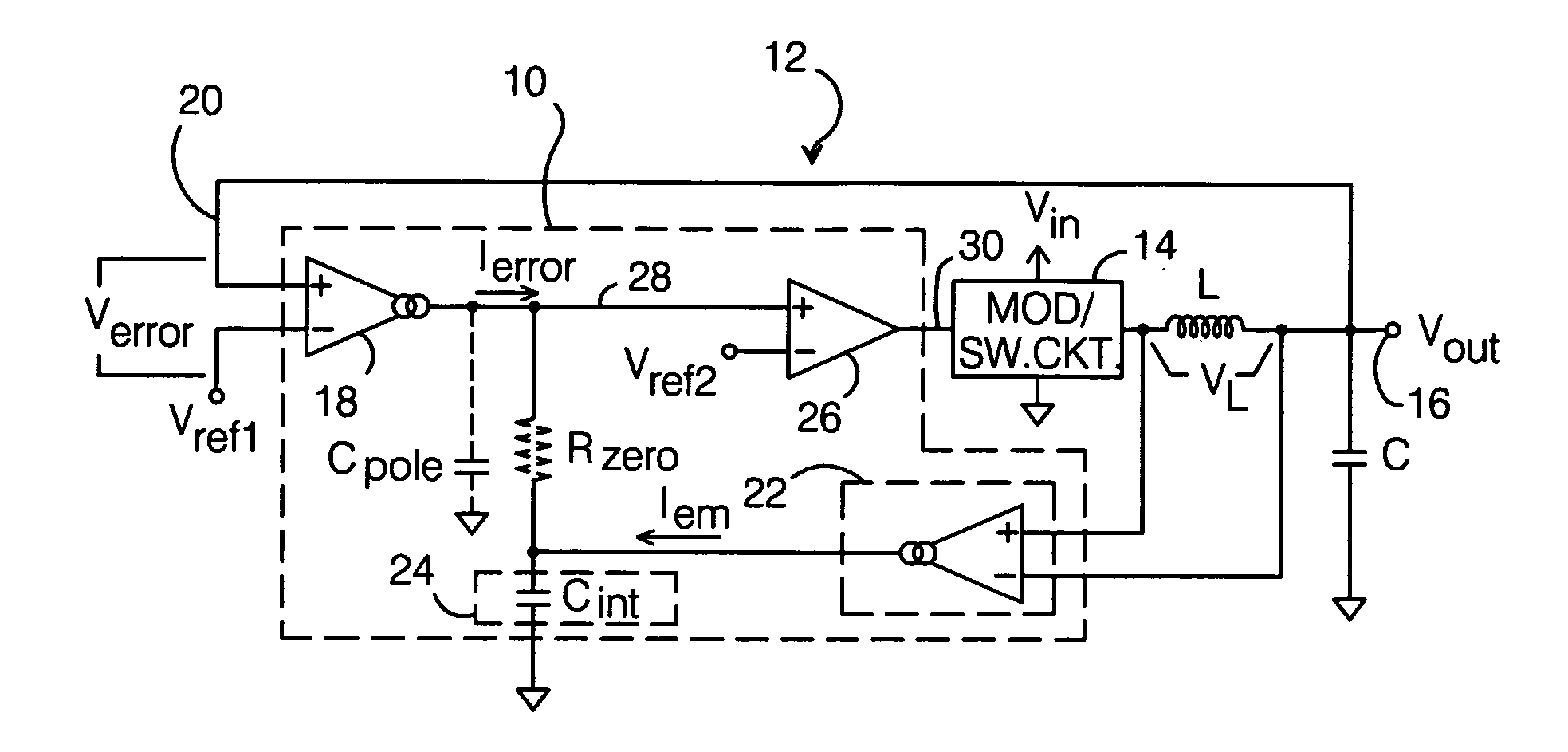

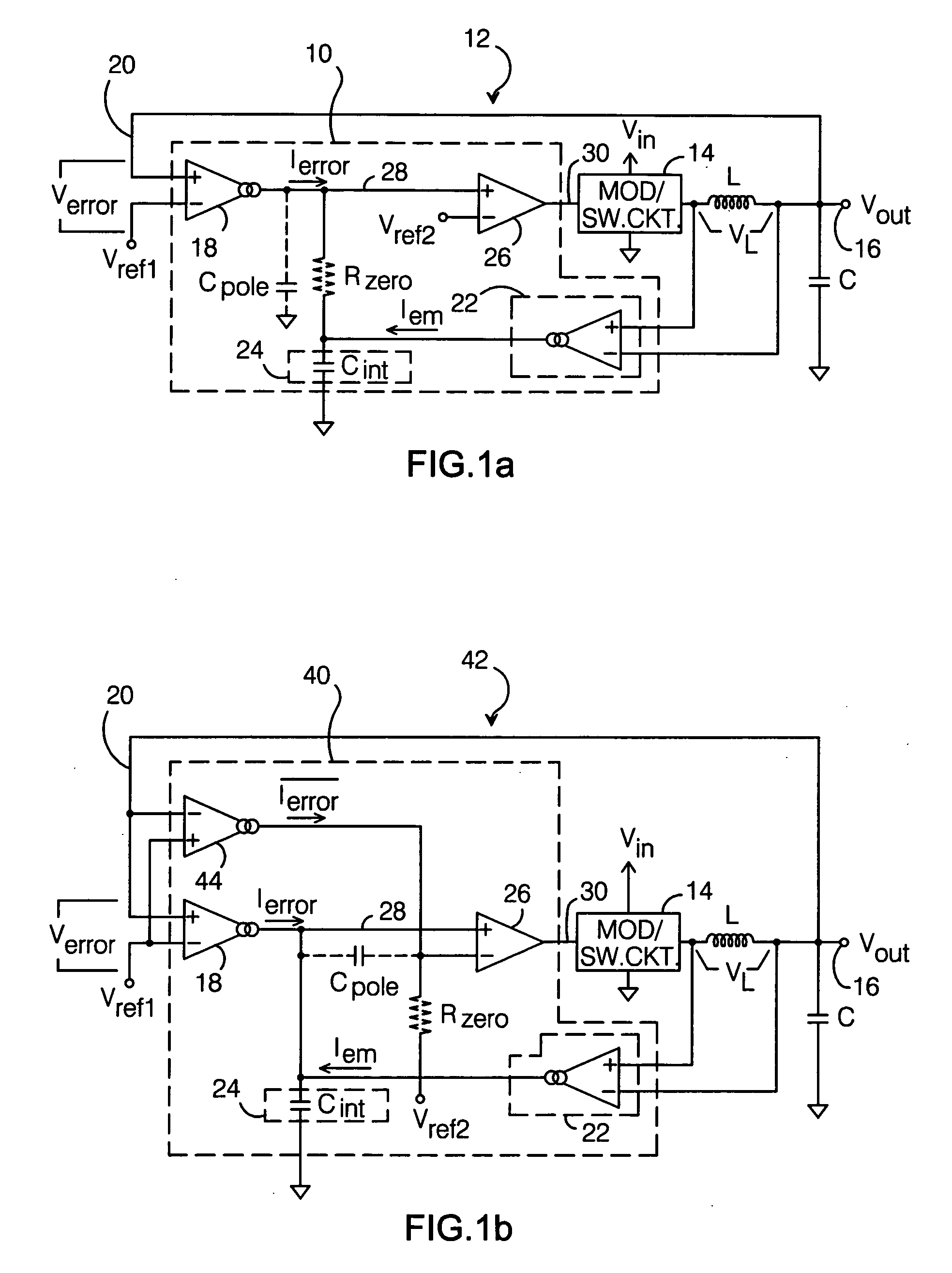

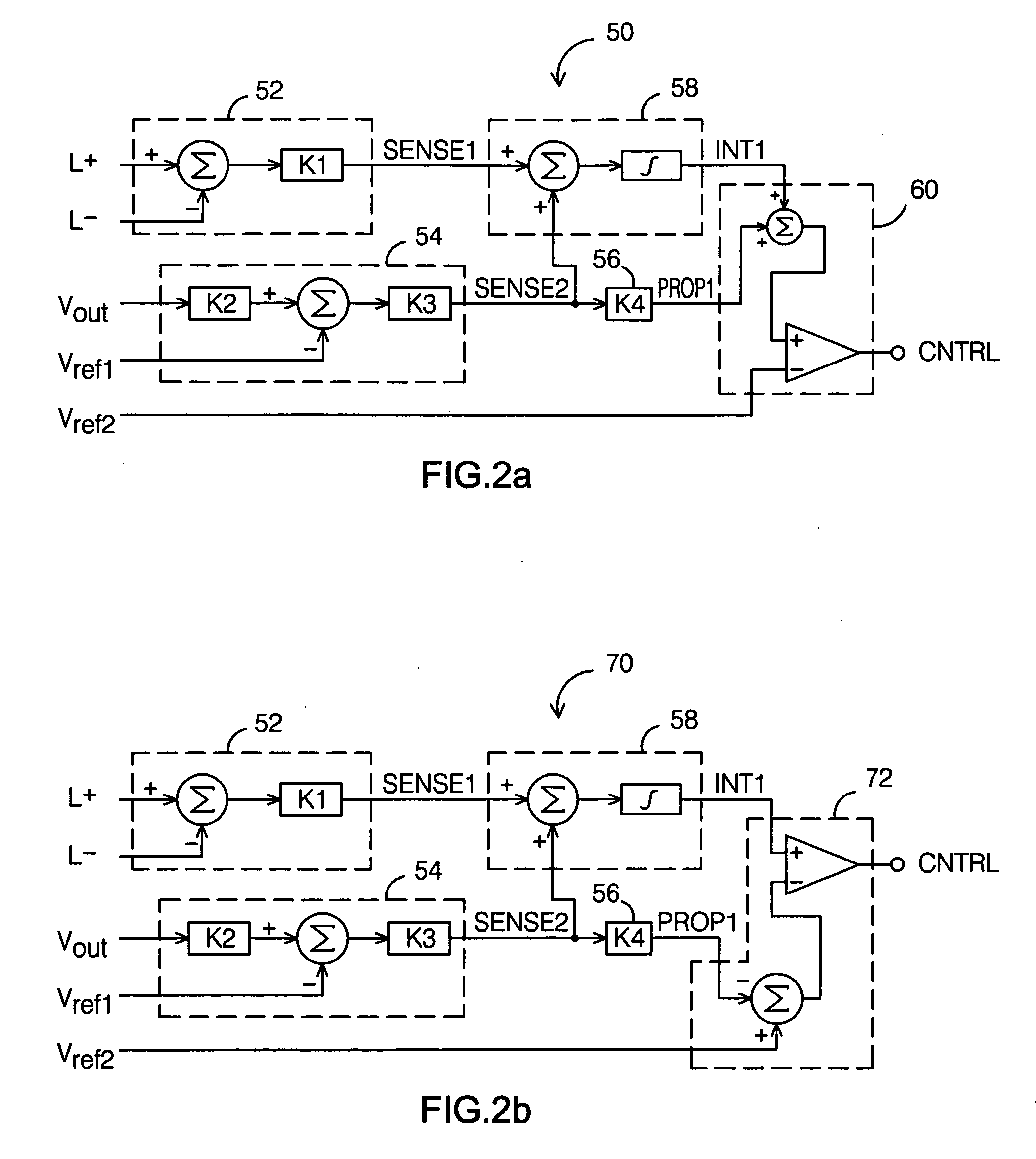

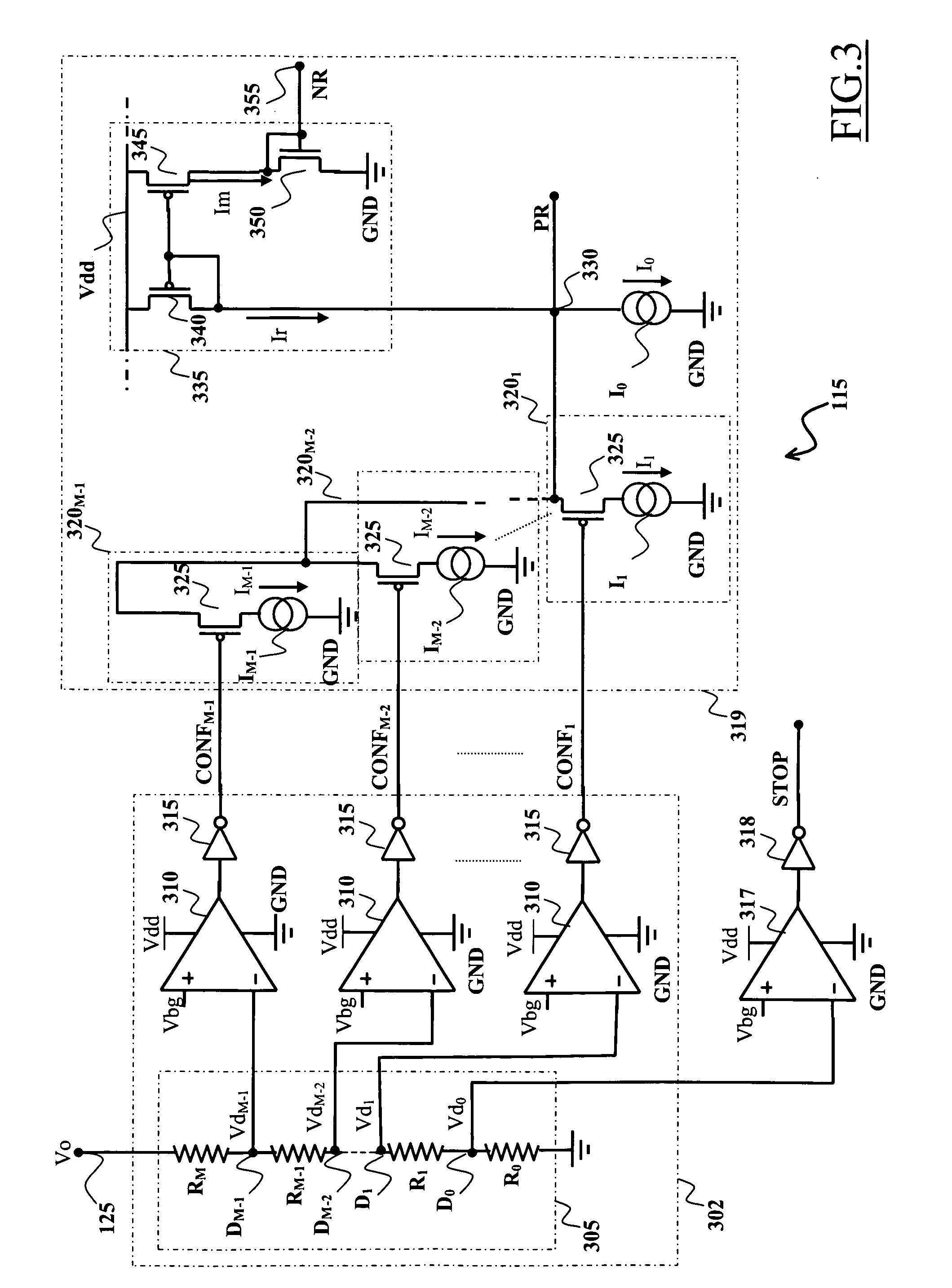

Single integrator sensorless current mode control for a switching power converter

ActiveUS20090146634A1Simple to implementHigh frequency operationDc-dc conversionElectric variable regulationIntegratorVoltage reference

A single integrator sensorless current mode control scheme for a switching power converter requires an amplifier circuit which produces an first current that varies with the difference Verror between a reference voltage and a voltage that varies proportionally with Vout, a circuit which produces a second current that varies with the voltage VL across the output inductor, a single integrating element connected to receive the first and second currents such that it integrates both Verror and VL, and a comparator which receives the integrated output at its first input and a substantially fixed voltage at its second input and produces an output that toggles when the voltage at its first input increases above and falls below the substantially fixed voltage. The comparator output is used to control the operation of the power converter's switching circuit and thereby regulate the output voltage.

Owner:ANALOG DEVICES INC

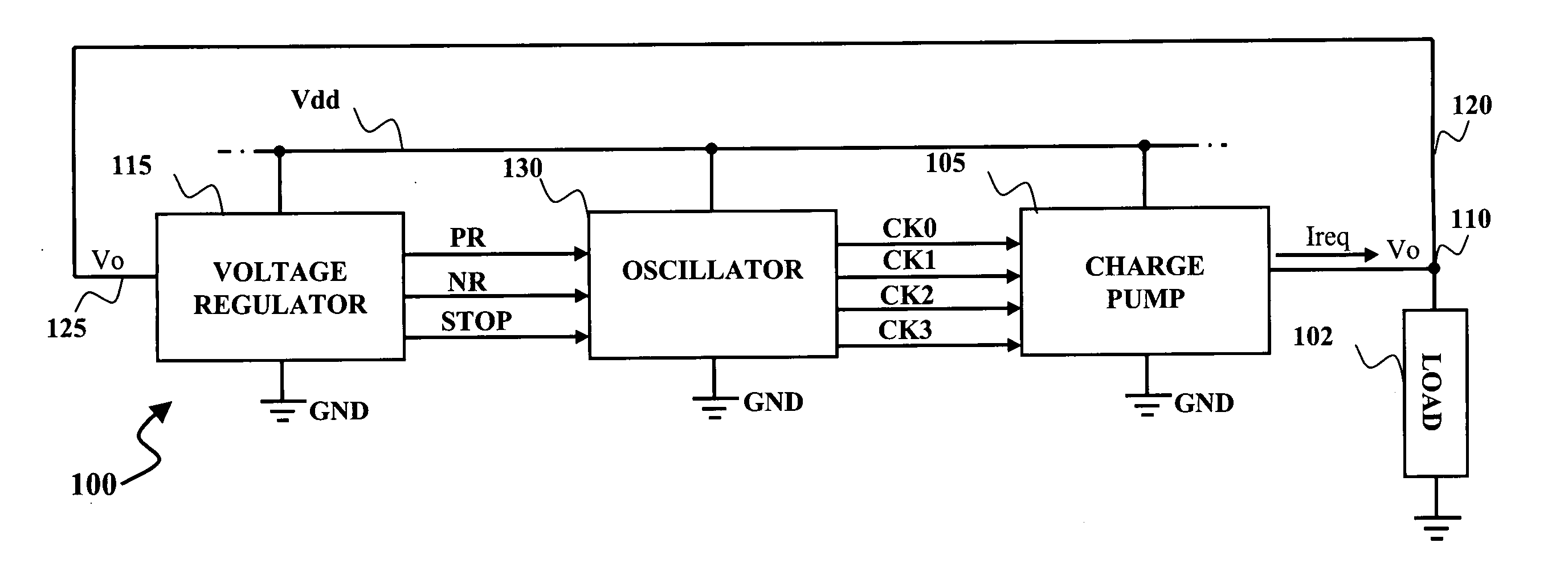

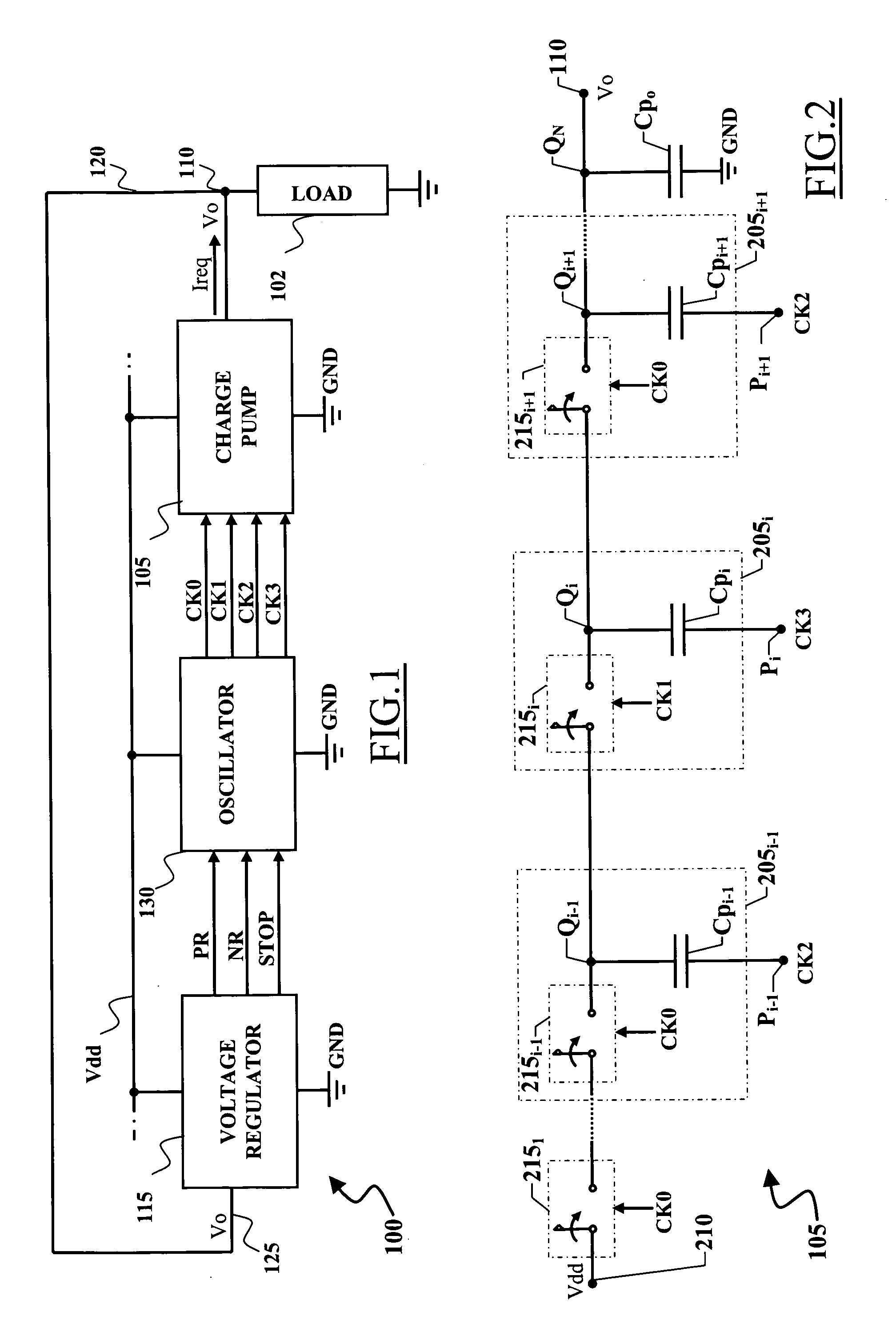

Voltage booster

ActiveUS20080024198A1Simple to implementFaster operationApparatus without intermediate ac conversionElectric pulse generator detailsVoltage referenceEngineering

A voltage booster for generating a boosted voltage, including a charge pump adapted to generate the boosted voltage starting from a supply voltage by a transfer of electric charge controlled by at least one oscillating signal having an oscillation frequency; an oscillator for providing the oscillating signal; and a regulation circuit arranged to receive and perform a comparison of a voltage related to the boosted voltage and a reference voltage, and adapted to provide at least one regulation signal indicative of a result of said comparison, wherein said regulation signal is fed to the oscillator to control said oscillation frequency. The regulation circuit is adapted to cause the at least one regulation signal take one among a plurality of discrete values, depending on the result of the comparison, so that the oscillation frequency of the at least one periodical signal accordingly can take one among a plurality of discrete oscillation frequency values.

Owner:STMICROELECTRONICS SRL

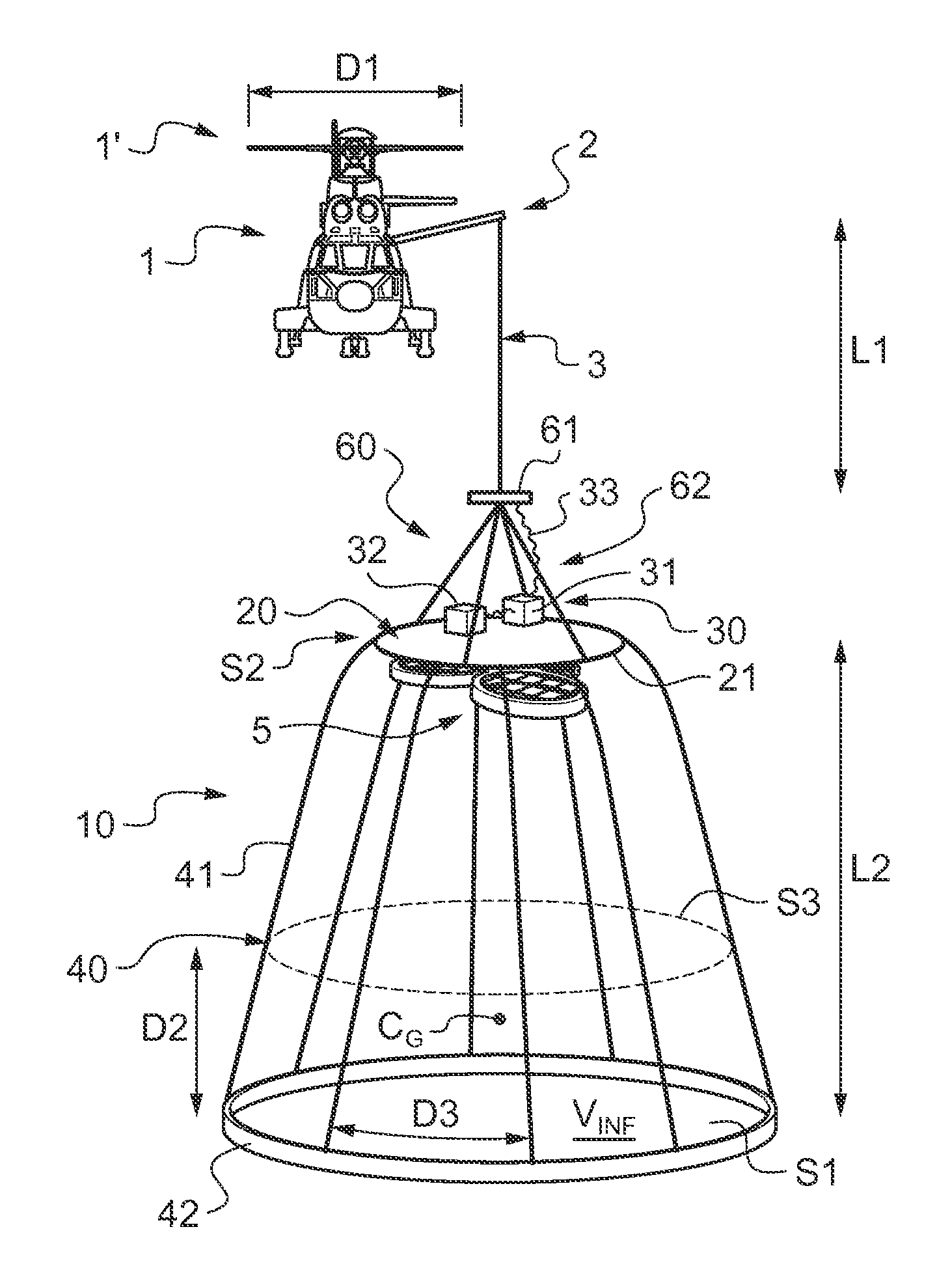

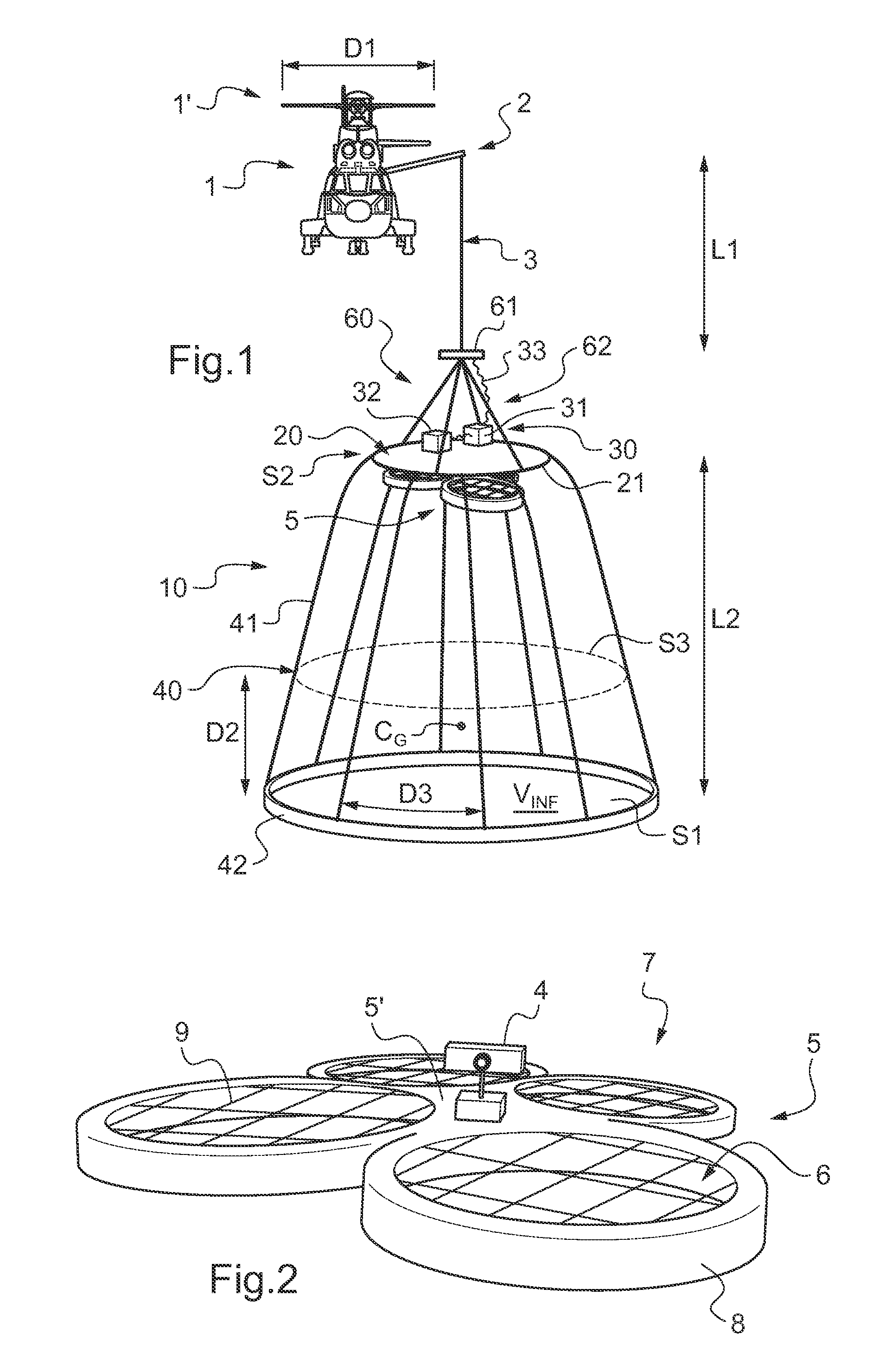

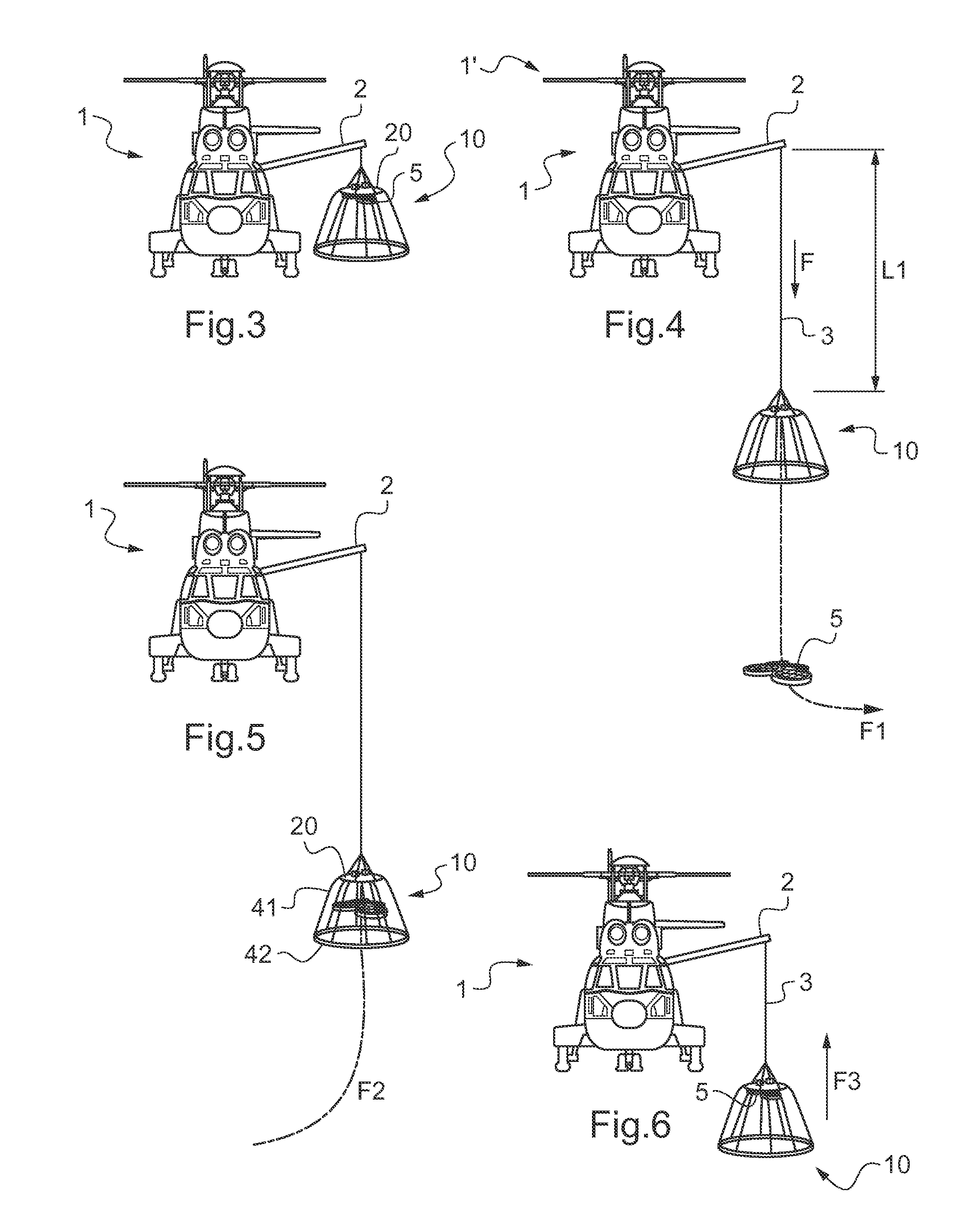

Device for launching and recovering a drone, and an associated aircraft

InactiveUS20120292430A1Simple to implementEasy to implementConvertible aircraftsArresting gearAirplane

A device (10) for launching and recovering a drone (5), the device being suitable for being fastened to an aircraft. The device includes docking means (20) for a drone (5), the docking means (20) being provided with securing / releasing means (30) for the drone (5), said docking means (20) being secured to flared guide means (40) for guiding the drone (5) towards said docking means (20).

Owner:EUROCOPTER

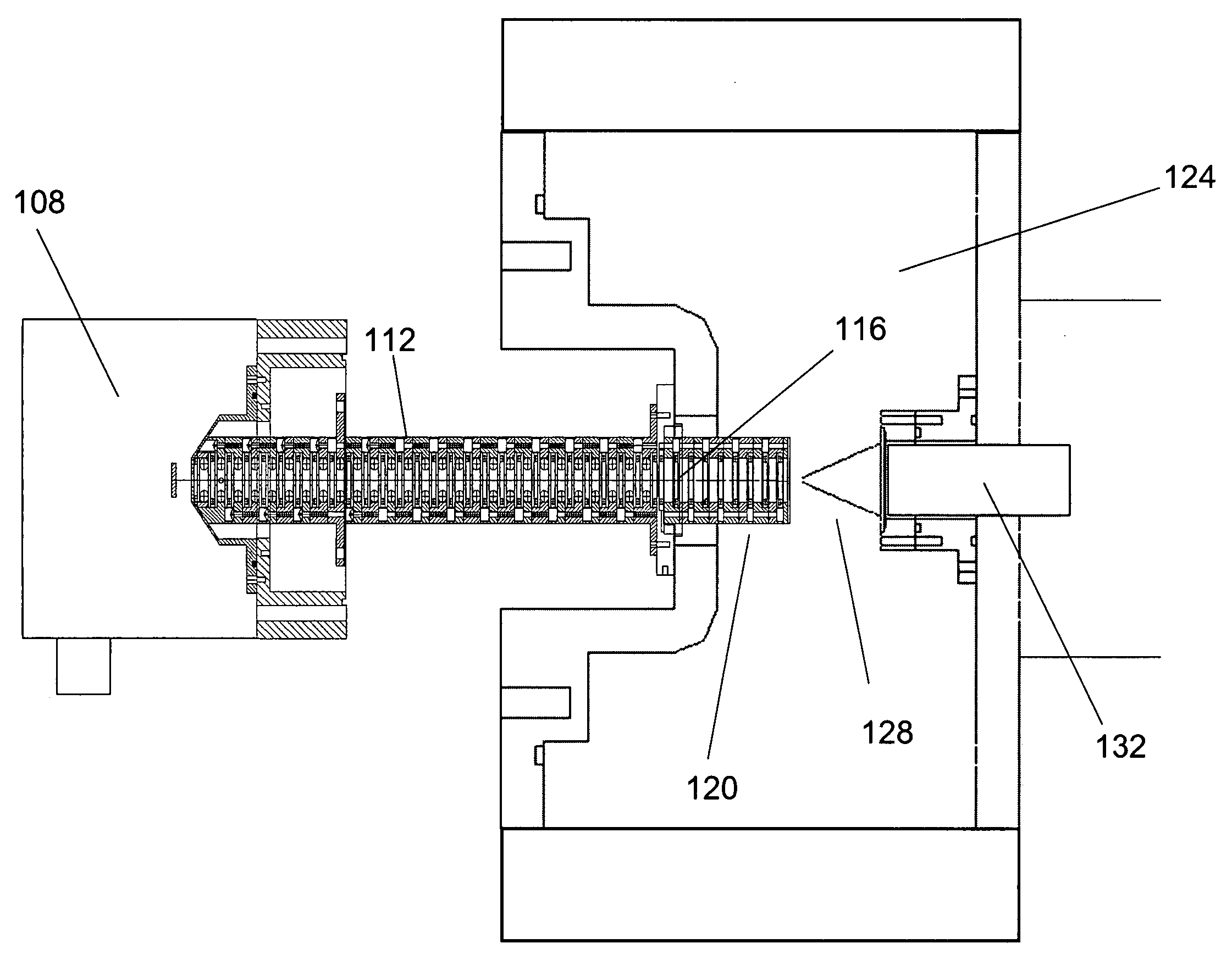

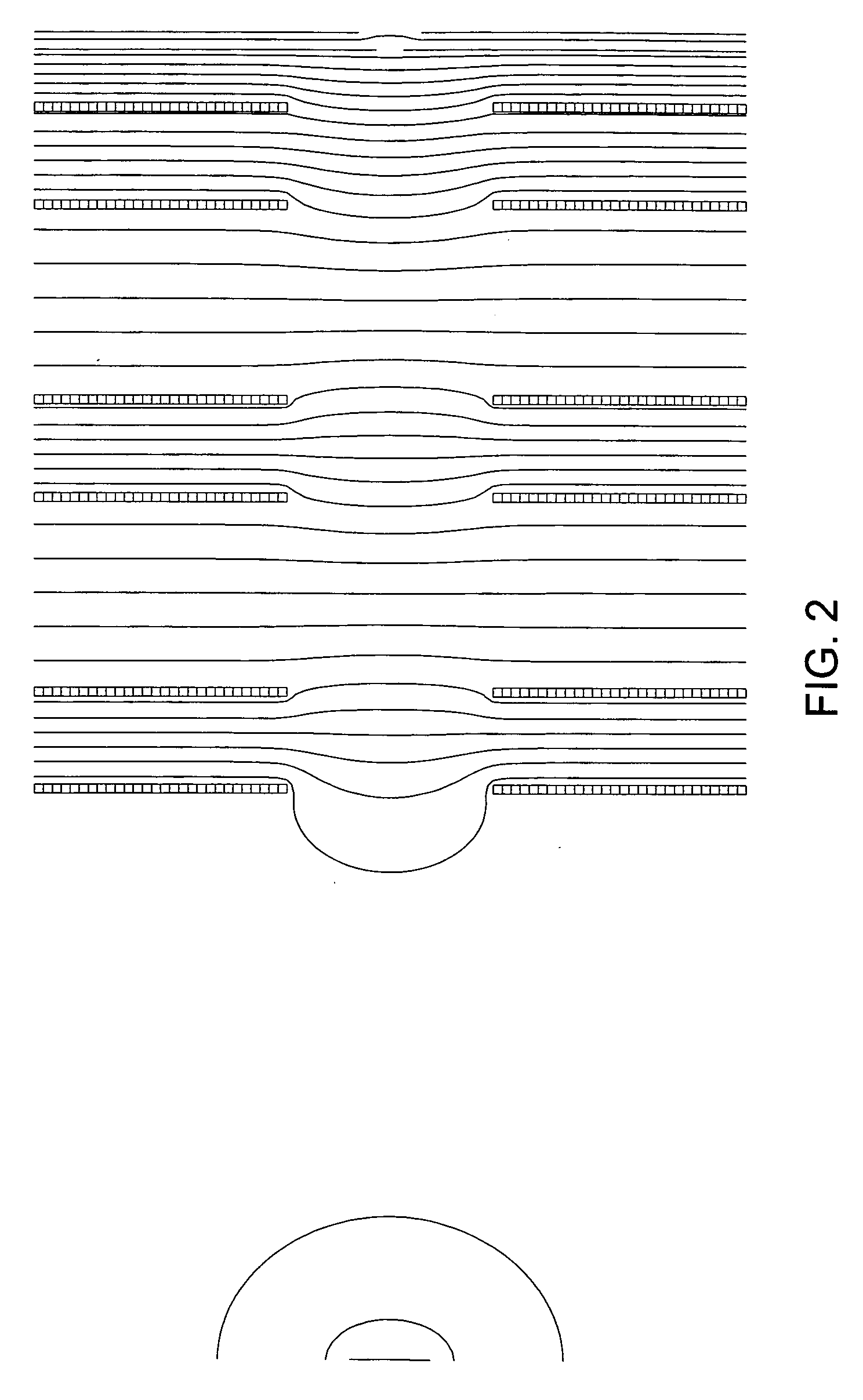

Ion mobility TOF/MALDI/MS using drift cell alternating high and low electrical field regions

ActiveUS20050109931A1Good mobility resolutionSimple to implementTime-of-flight spectrometersMaterial analysis by electric/magnetic meansPhysicsIon

Owner:IONWERKS

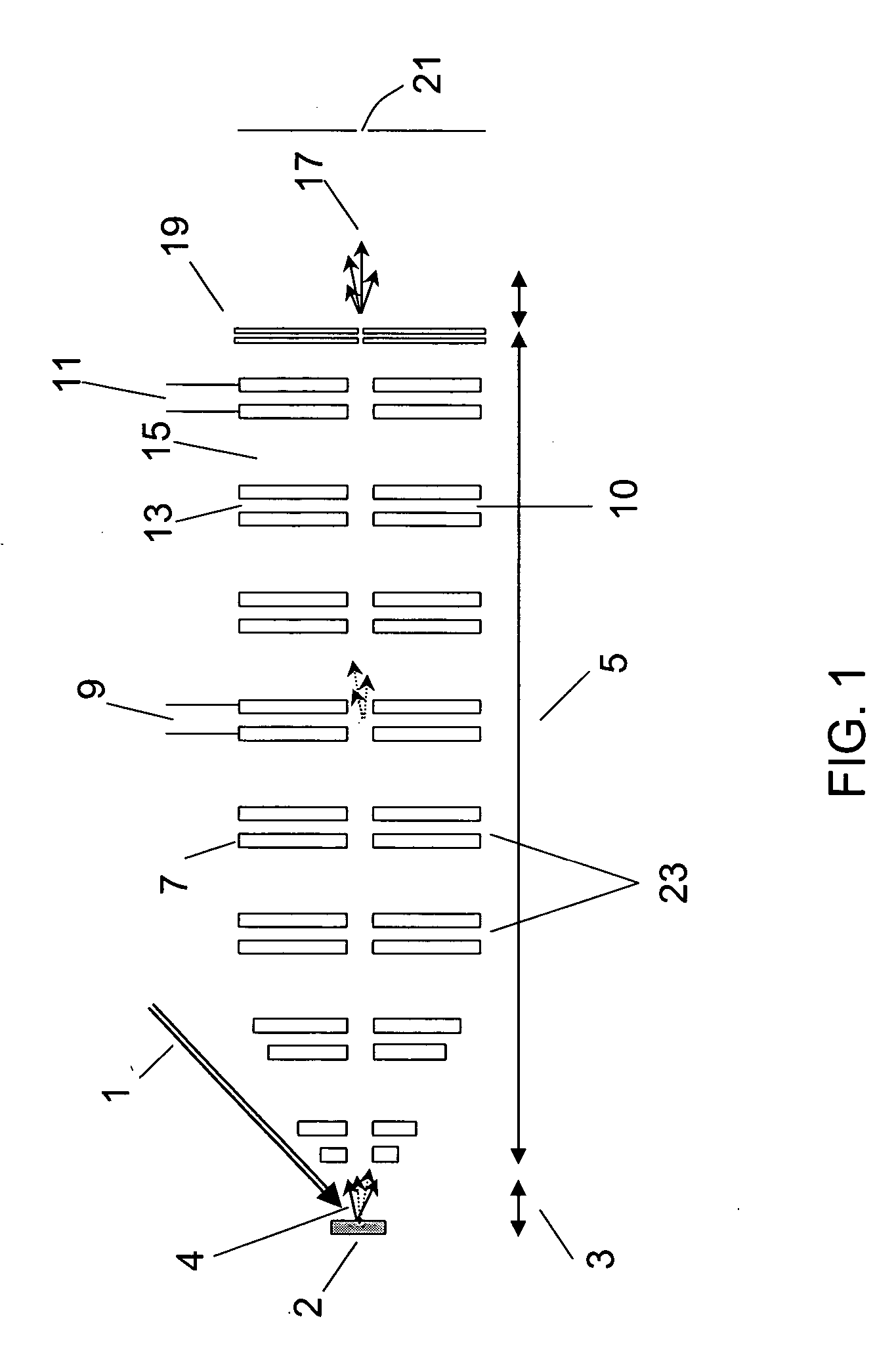

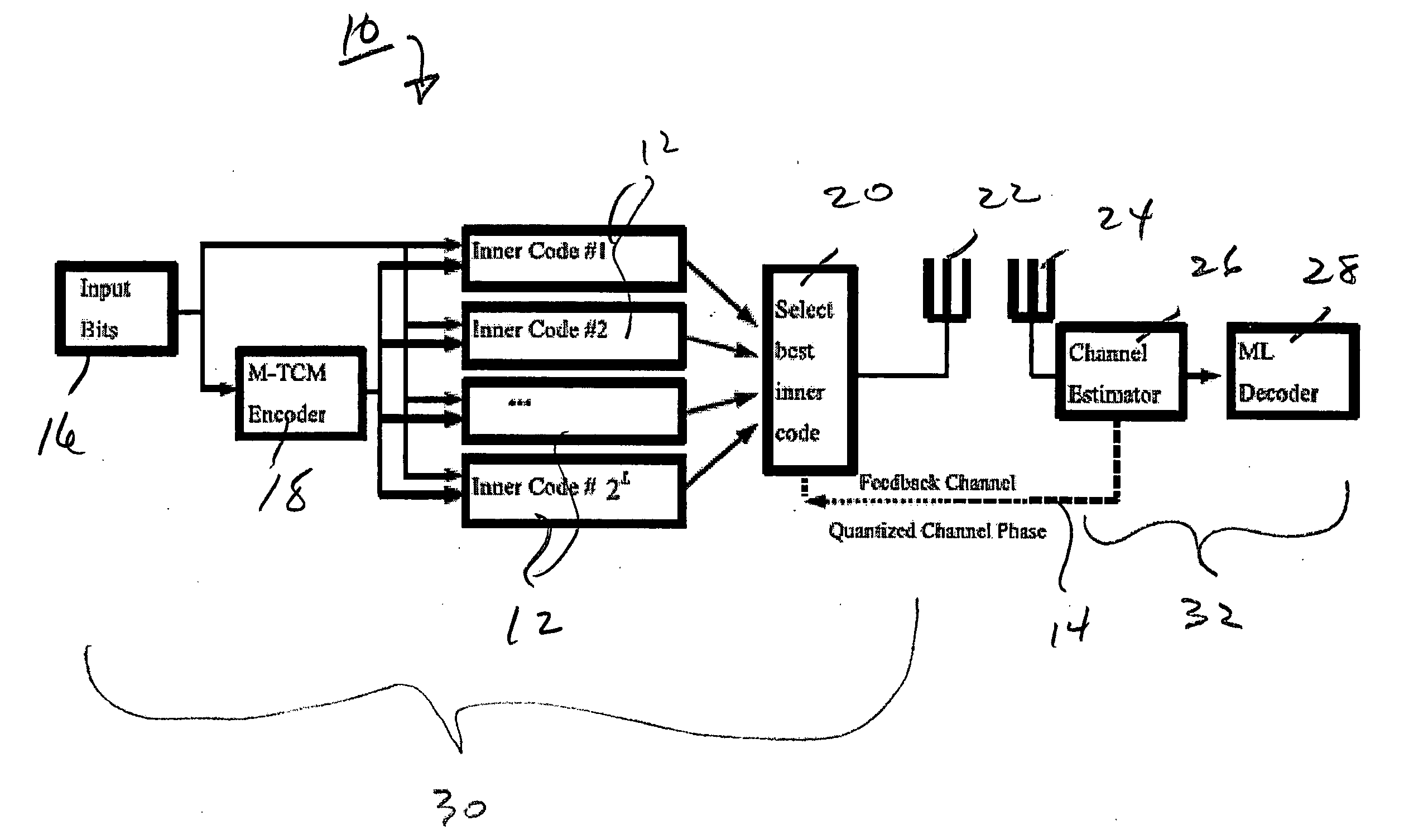

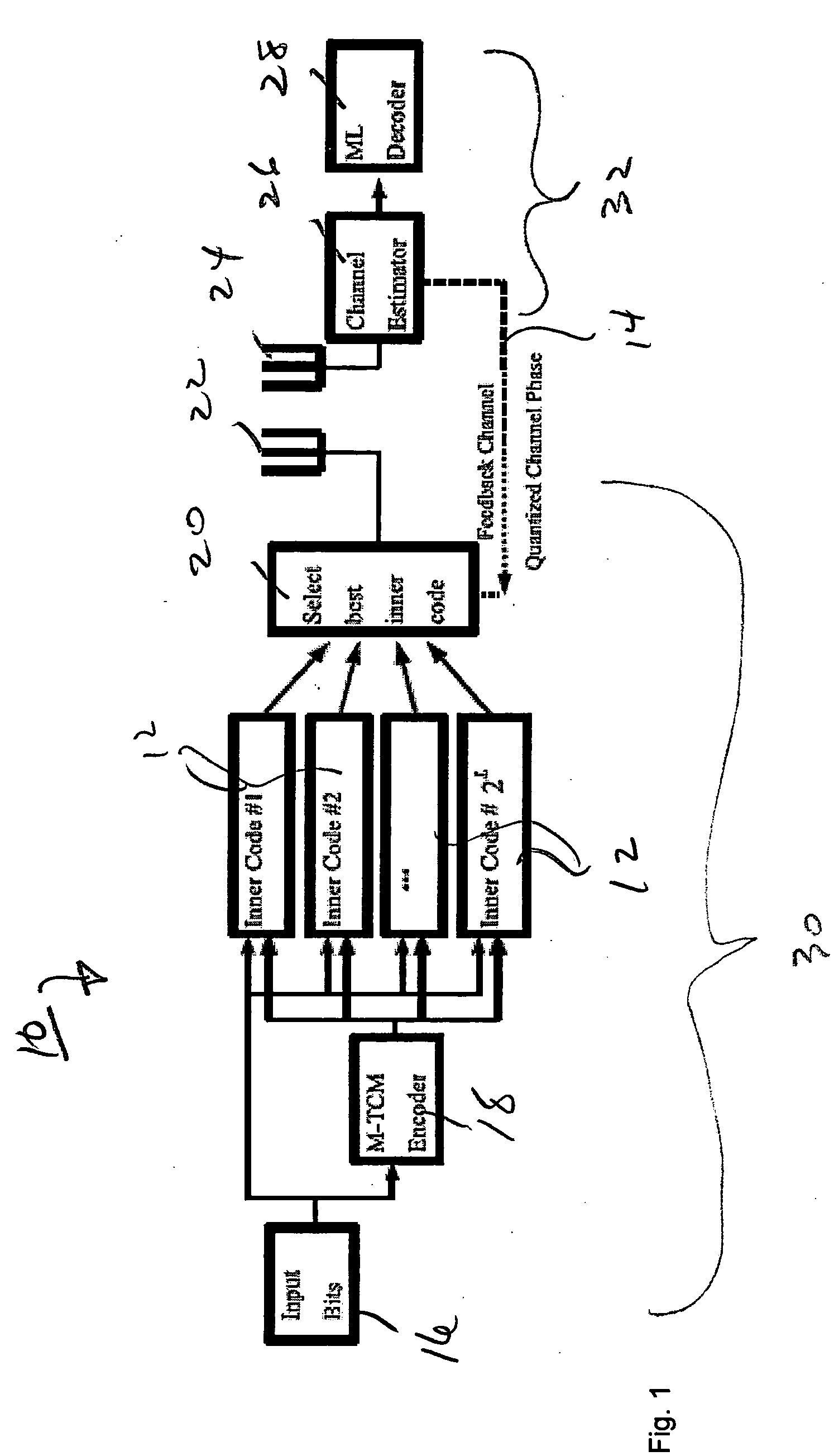

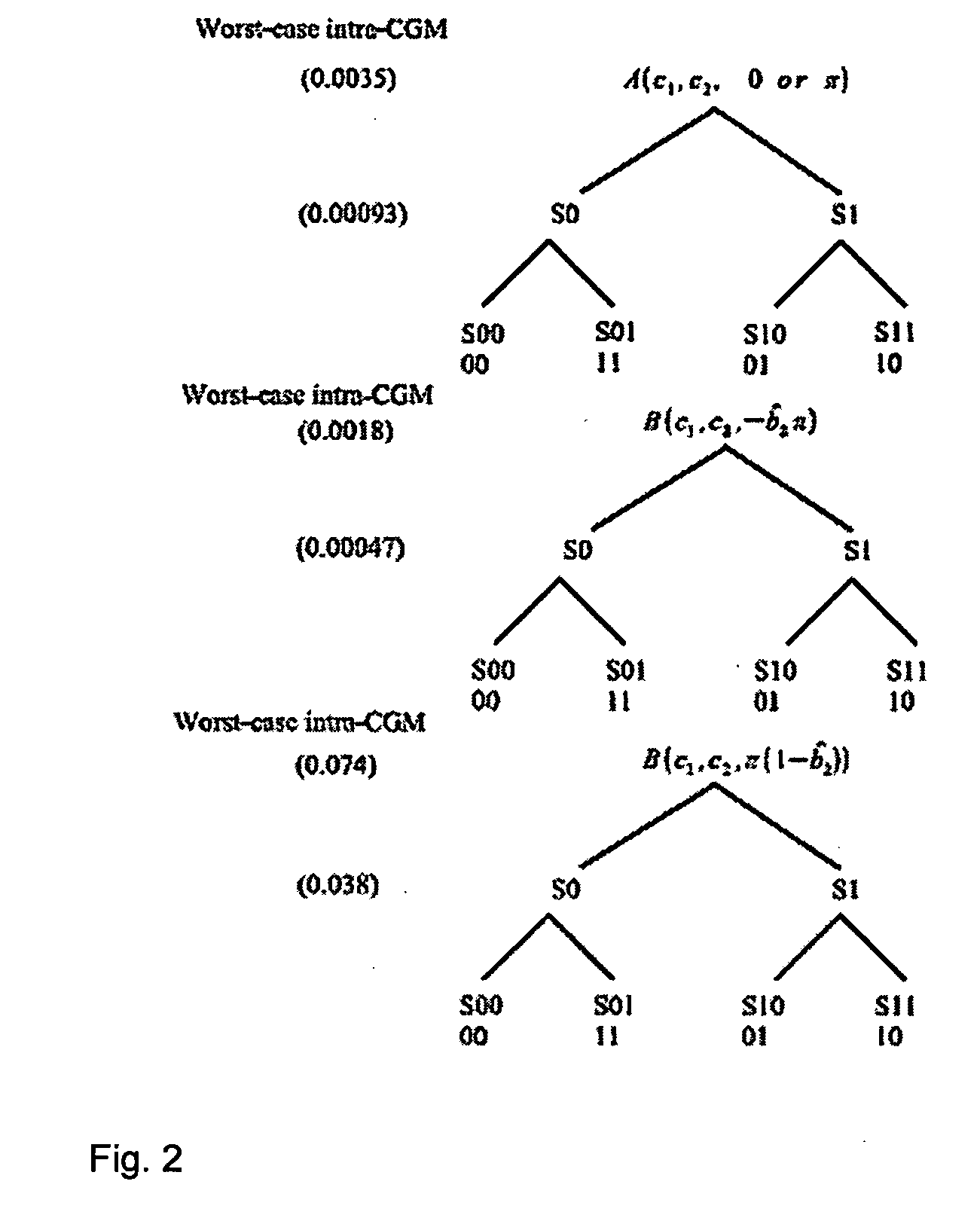

Method and apparatus for use of space time trellis codes based on channel phase feedback

ActiveUS20060176977A1Superior error performanceSimple to implementMultiple-port networksMultiplex communicationBlock codeCellular network

A method for MIMO wireless communication comprises the steps of generating inner and outer codes based on channel state information available at a transmitter and concatenating different inner codes with different outer codes; and using the generated concatenated inner and outer codes for wireless communication. The inner and outer codes are based on channel phase information at the transmitter or channel feedback. High-performance trellis codes or block codes for use in cellular networks are illustratively described. The space-time trellis codes are generated by set partitioning on a plurality of classes of signal designs to generate a series of inner codes, each of the series of inner codes being optimized by channel phase feedback, and concatenating each inner code with a multiple trellis coded modulated outer code to provide a complete space-time trellis code as a cophase space-time trellis code.

Owner:RGT UNIV OF CALIFORNIA

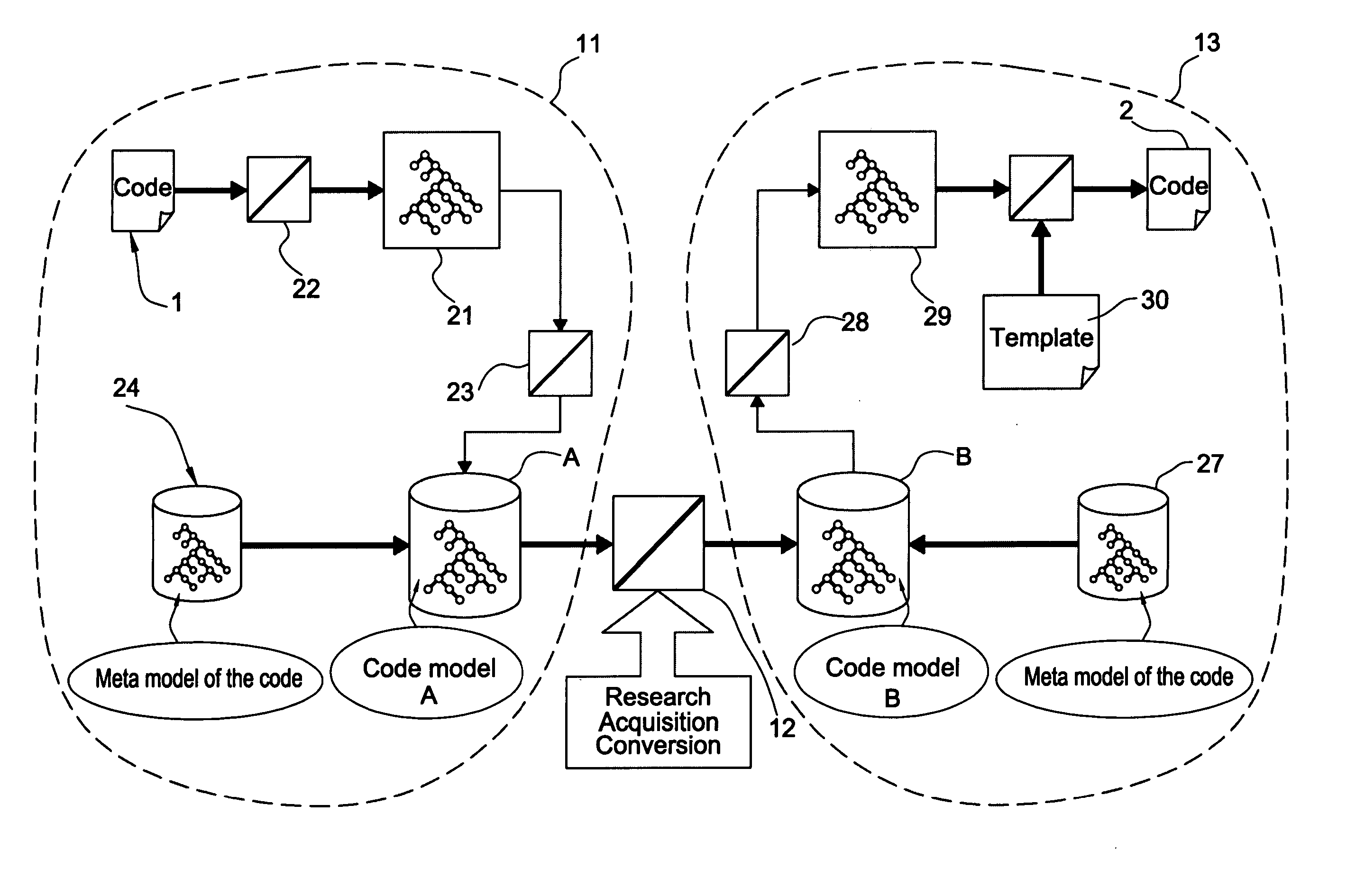

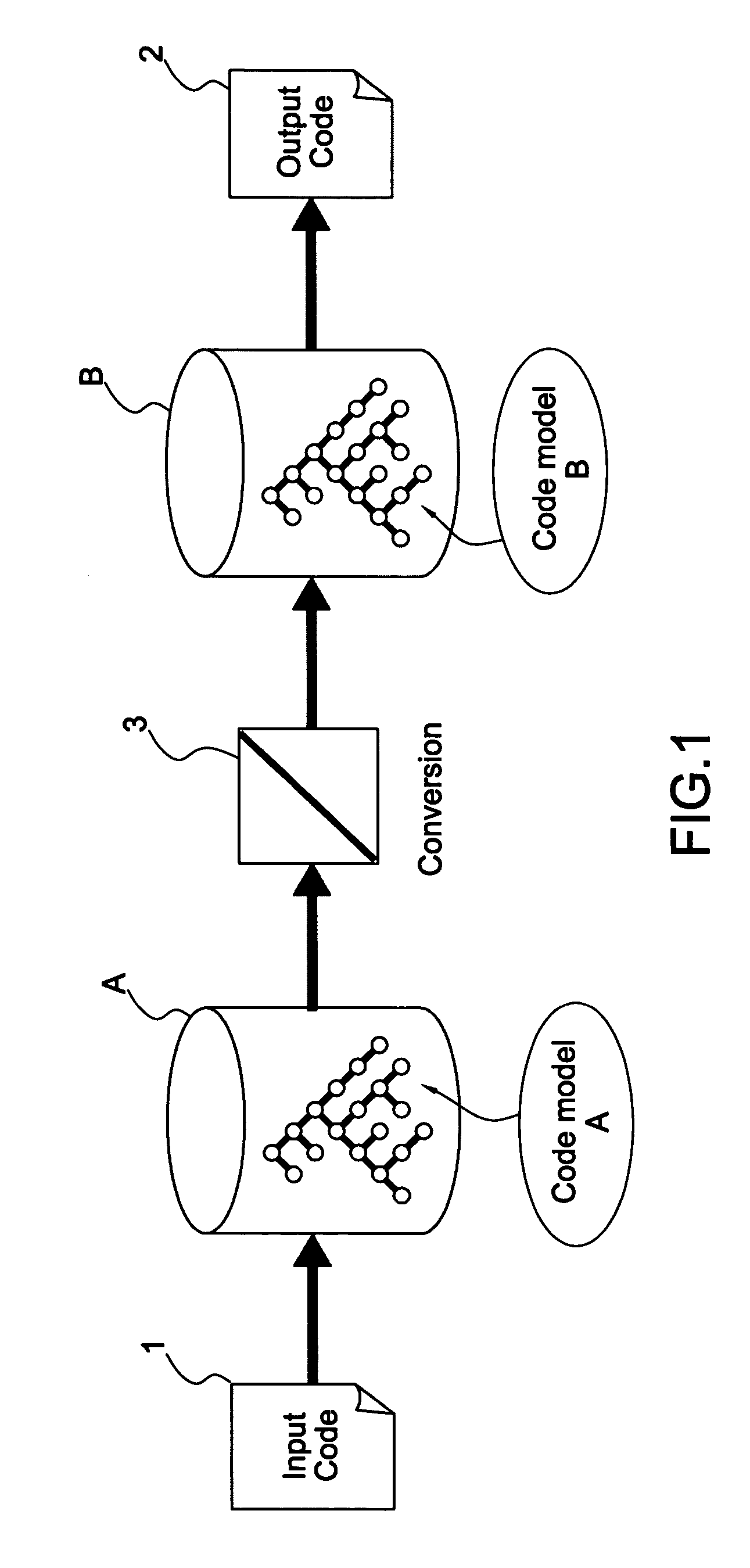

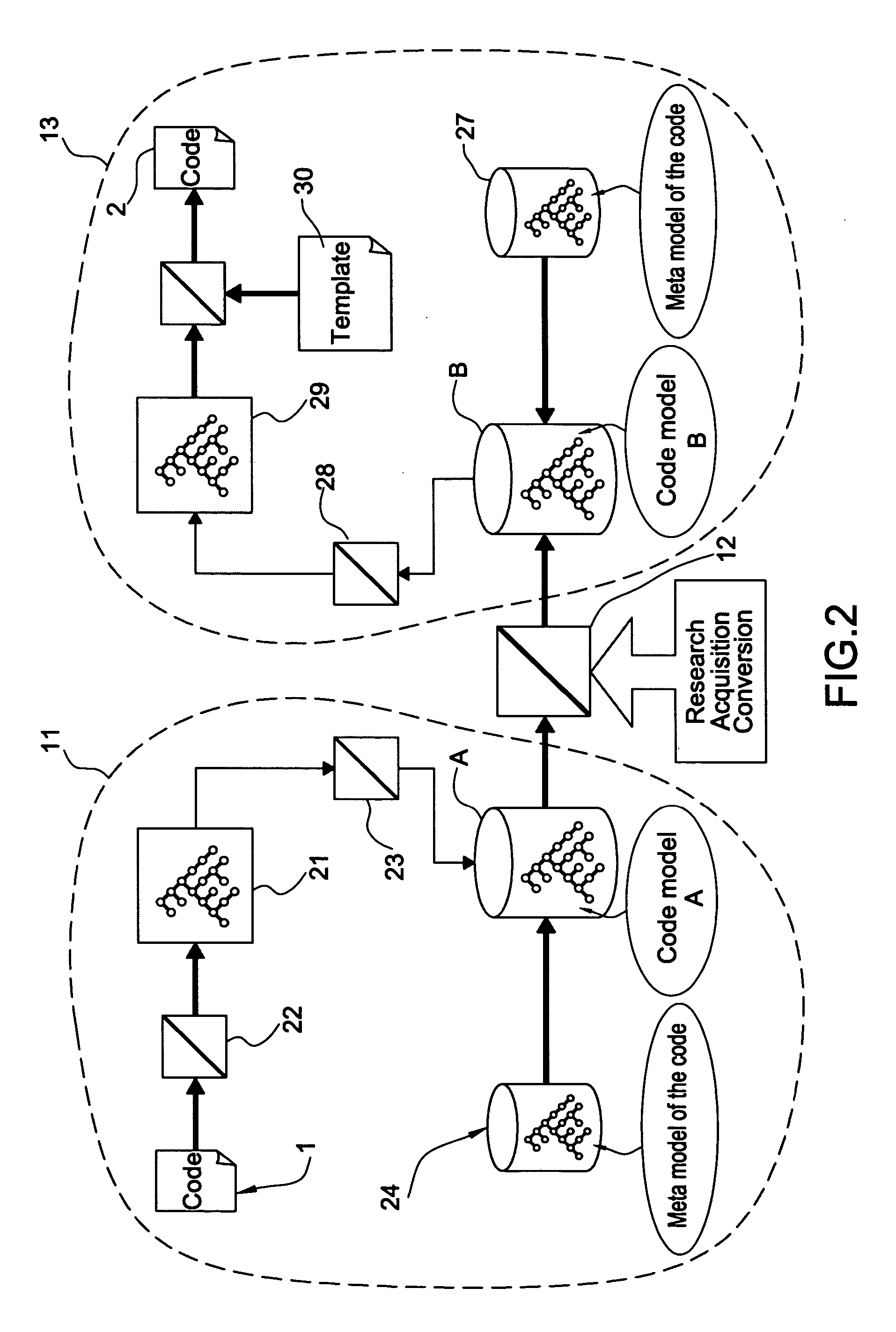

Method of computer code conversion and computer product/program for the implementation of such a method

InactiveUS20060005172A1Simple to implementAvoid complicated actionSoftware engineeringProgram controlObject modelCode conversion

The method comprises at least: a first step (11) for the acquisition of a code object model A from the original code (1); a second step (12) of conversion of the code object model A into a new object model B; a third step (13) of the generation of a code from the new model B. The invention applies especially to the automatic conversion of existing validated code, either from one language to another or within the same language through a modification of the original code, for example in order to correct its errors.

Owner:THALES SA

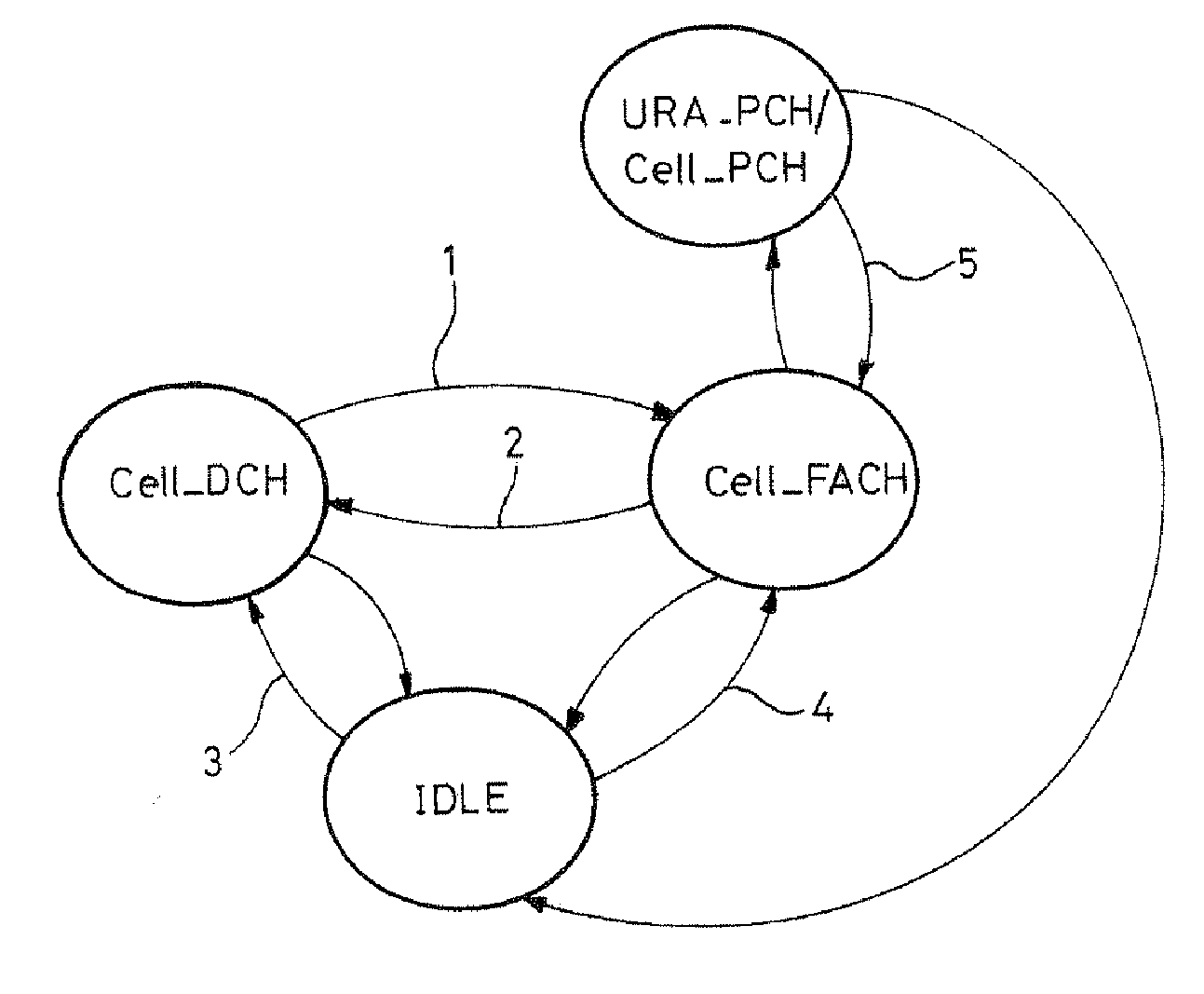

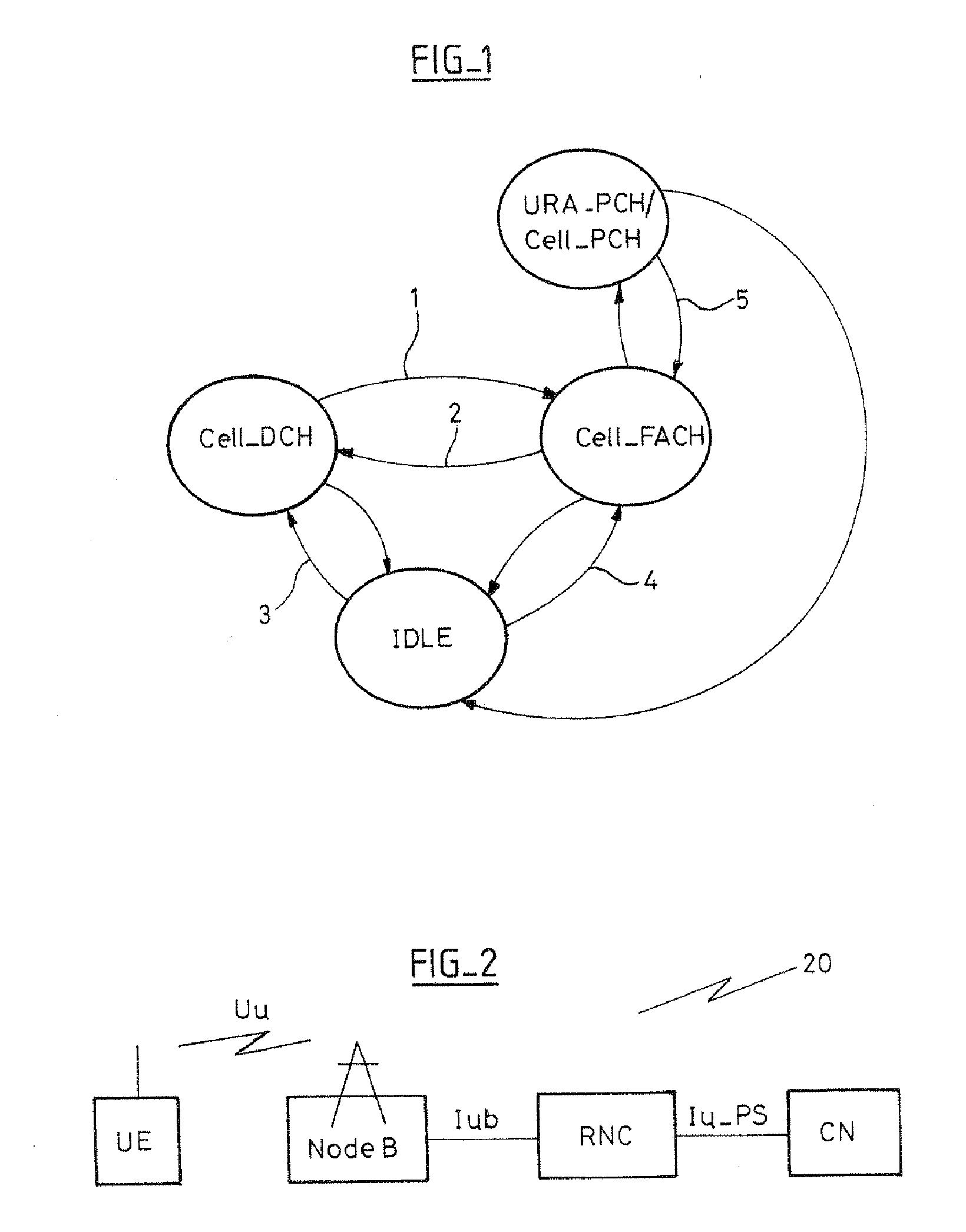

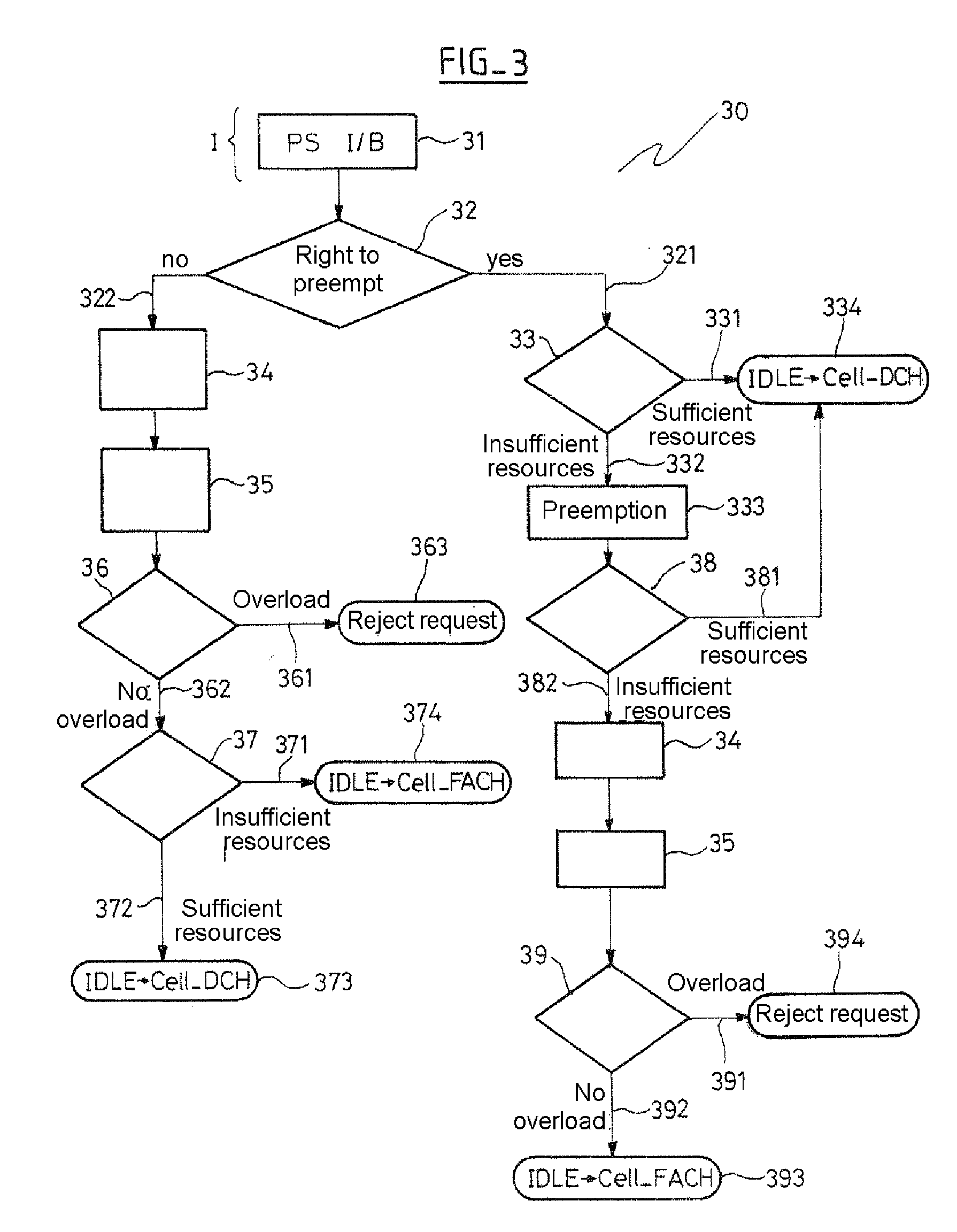

Method and device for management of an overload in a cell of a radio communication network, corresponding uses, computer program and storage means

ActiveUS20070135113A1Simple to implementMinimize waiting timeNetwork traffic/resource managementStore-and-forward switching systemsTelecommunicationsComputer program

The invention concerns a method of managing an overload in a cell of a cellular radio communication network comprising a plurality of user equipments (UE) each of which can switch between a plurality of states including a Cell_DCH state and a Cell_FACH state. According to the invention, this kind of method comprises the following steps, for each request (RAB request) for allocation of radio resources to a given user equipment in an initial state, before sending said request, in which initial state no radio resource is allocated to said user equipment: obtaining for said cell a current rate of successful transitions for the change from the Cell_FACH state to the Cell_DCH state; detecting an overload of the Cell_FACH state by analyzing said current rate of successful transitions; if an overload is detected, rejecting said request; if no overload is detected, accepting said request and switching said user equipment from said initial state to a final state in which at least one radio resource is allocated to said user equipment.

Owner:WSOU INVESTMENTS LLC

Two-pressure switch

InactiveUS6498312B1High performanceSimple to implementSnap-action arrangementsSwitch side locationRest positionContact zone

A press switch comprises an insulating substrate with two conductive zones suitable for triggering first and second functions, respectively. The first zone has at least two portions that are electrically insulated from each other. A spring has two contact zones, one of which includes at least two regions that are electrically interconnected and suitable for making contact with respective portions. In a rest position, the spring makes contact with at least part of the first conductive zone, and no function is performed. In a first actuated position, a first amount of pressure applied to the spring causes it to make full contact with the first conductive zone, thereby causing the first function to be performed. In a second actuated position, a second amount of pressure causes contact to be made by each contact zone with the respective conductive zone, and the said function is performed.

Owner:DRNC HLDG INC

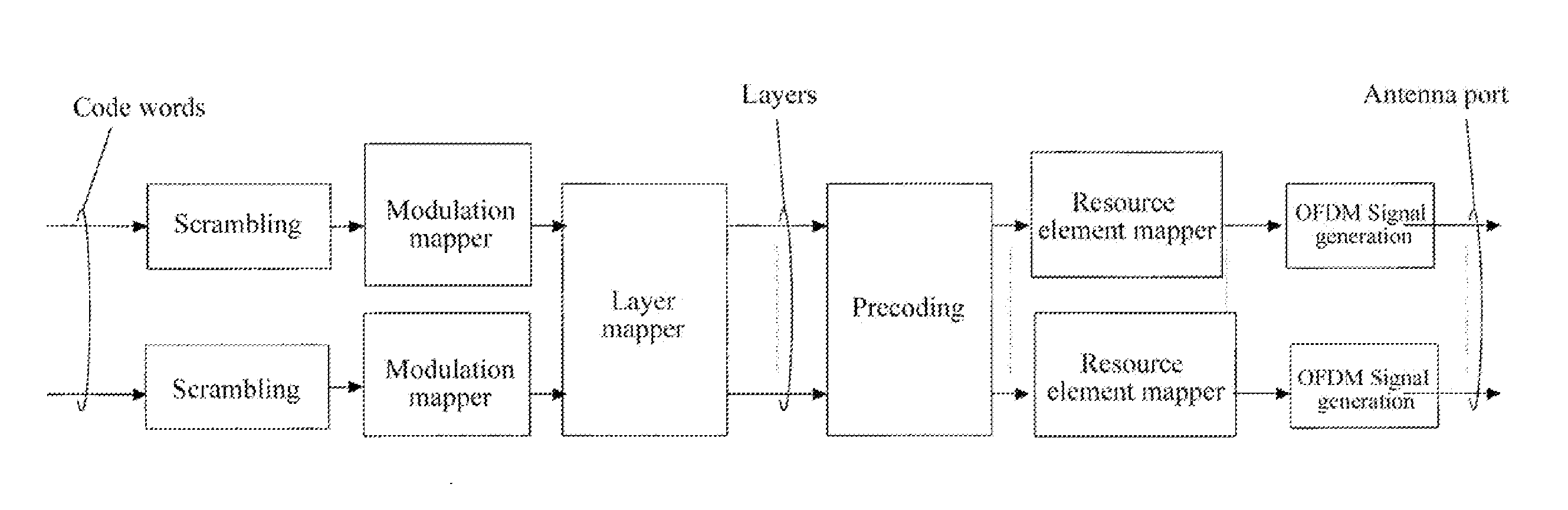

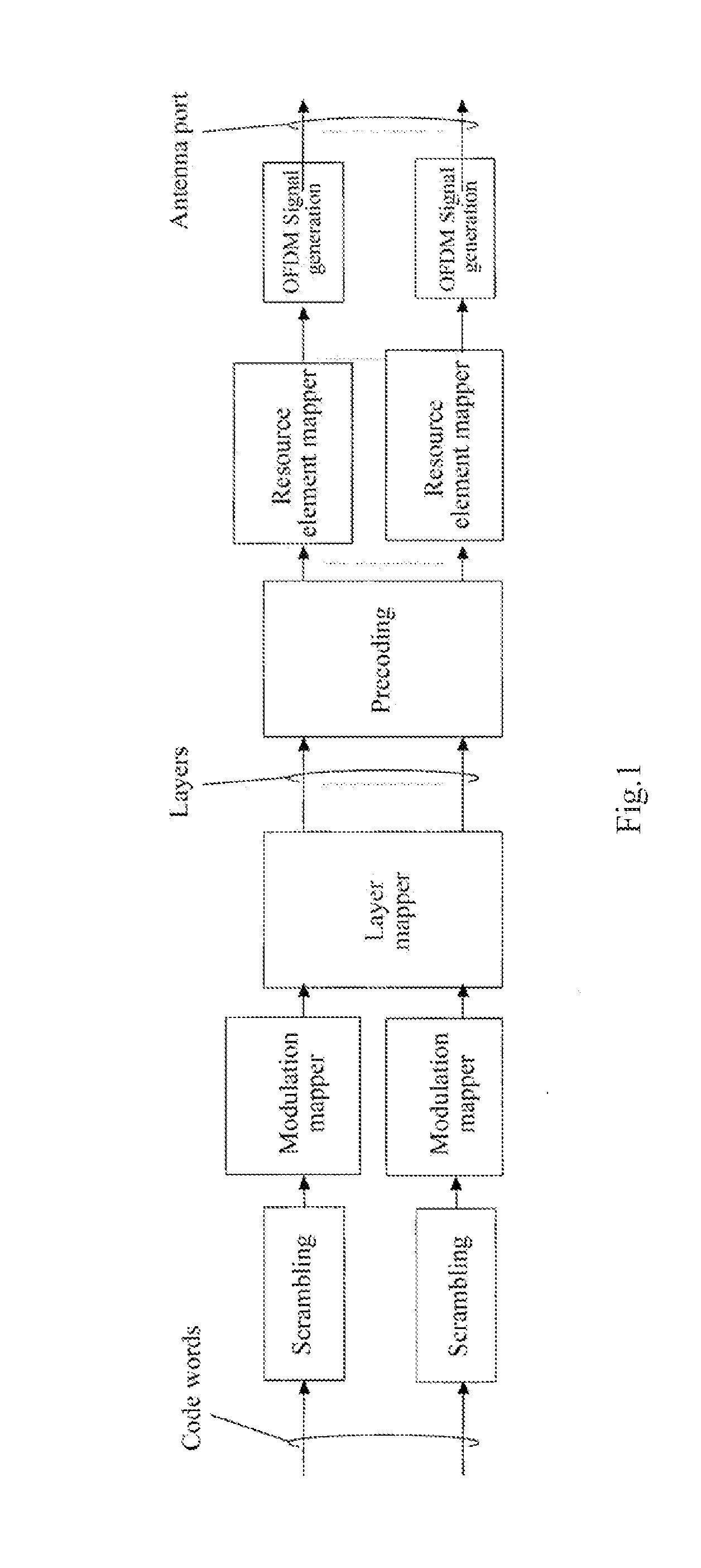

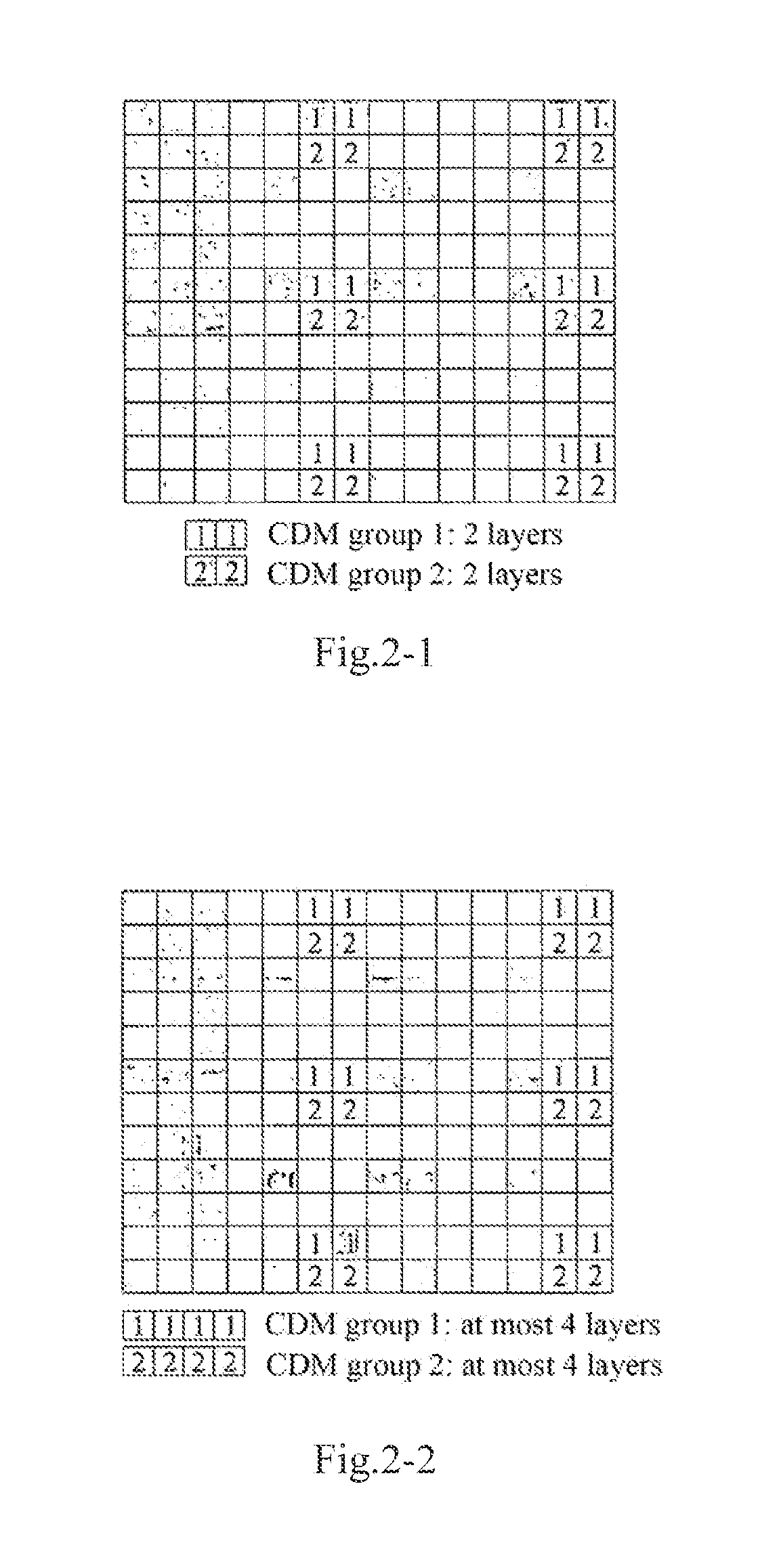

Method of and apparatus for mapping to demodulation reference signal port

ActiveUS20120300709A1Reduce overheadEfficient to implementError preventionCriteria allocationData streamComputer science

A demodulation reference signal port mapping method is disclosed. The method includes: a base station communicates with a User Equipment (UE), and allocates corresponding data stream to the UE according to the attribution of the UE; the base station maps the corresponding data stream from a layer to a corresponding demodulation reference signal port; the base station transmits the corresponding data stream to the UE via demodulation reference signal port. By restricting the demodulation reference signal port mapping solution of rank=1 to rank=8 and the demodulation reference signal port mapping solution when the retransmission occurs, the technical solution enables the demodulation reference signal port mapping solution to compatible with the present system and to keep lower overhead of the demodulation reference signal.

Owner:DATANG MOBILE COMM EQUIP CO LTD

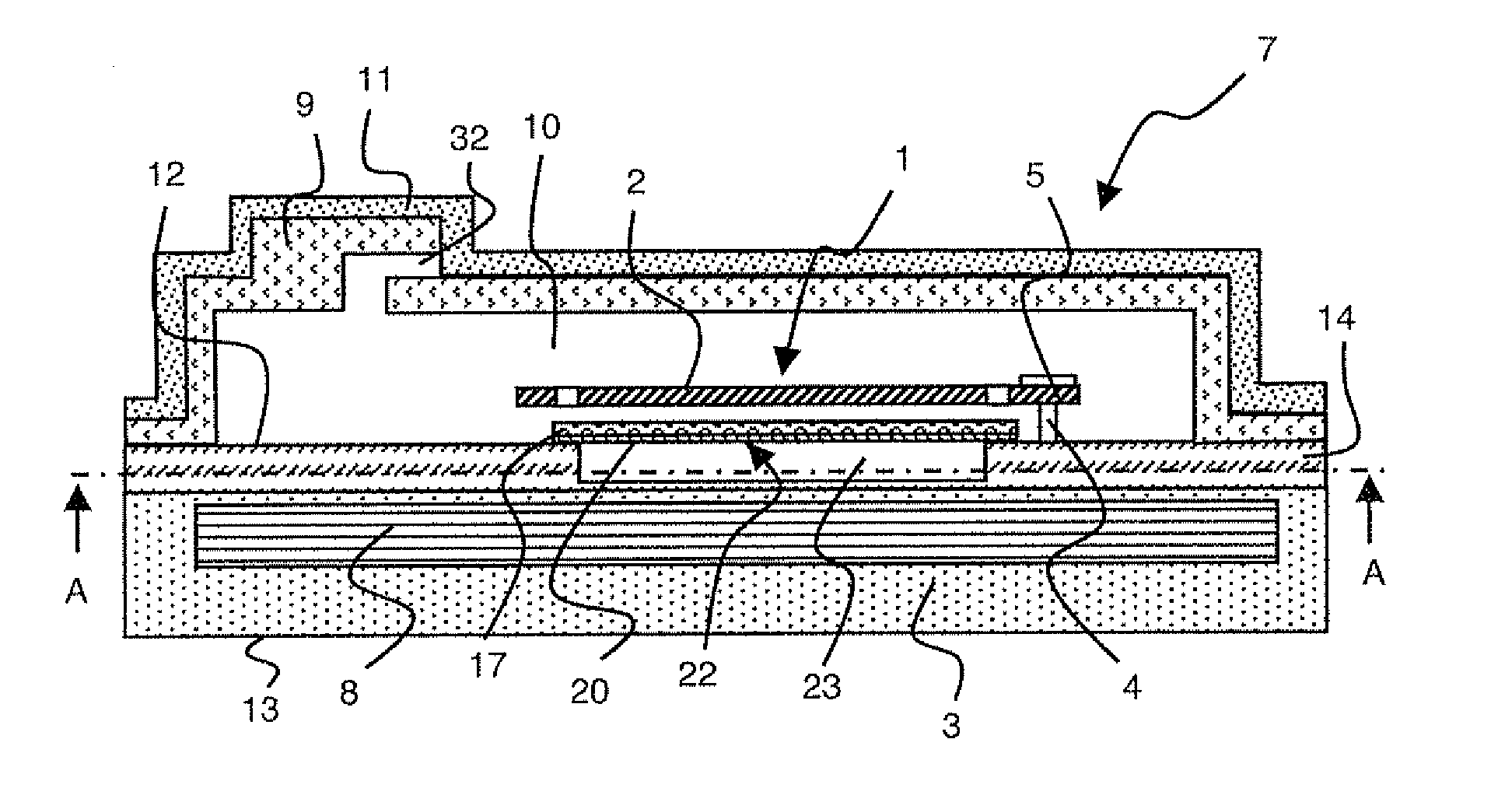

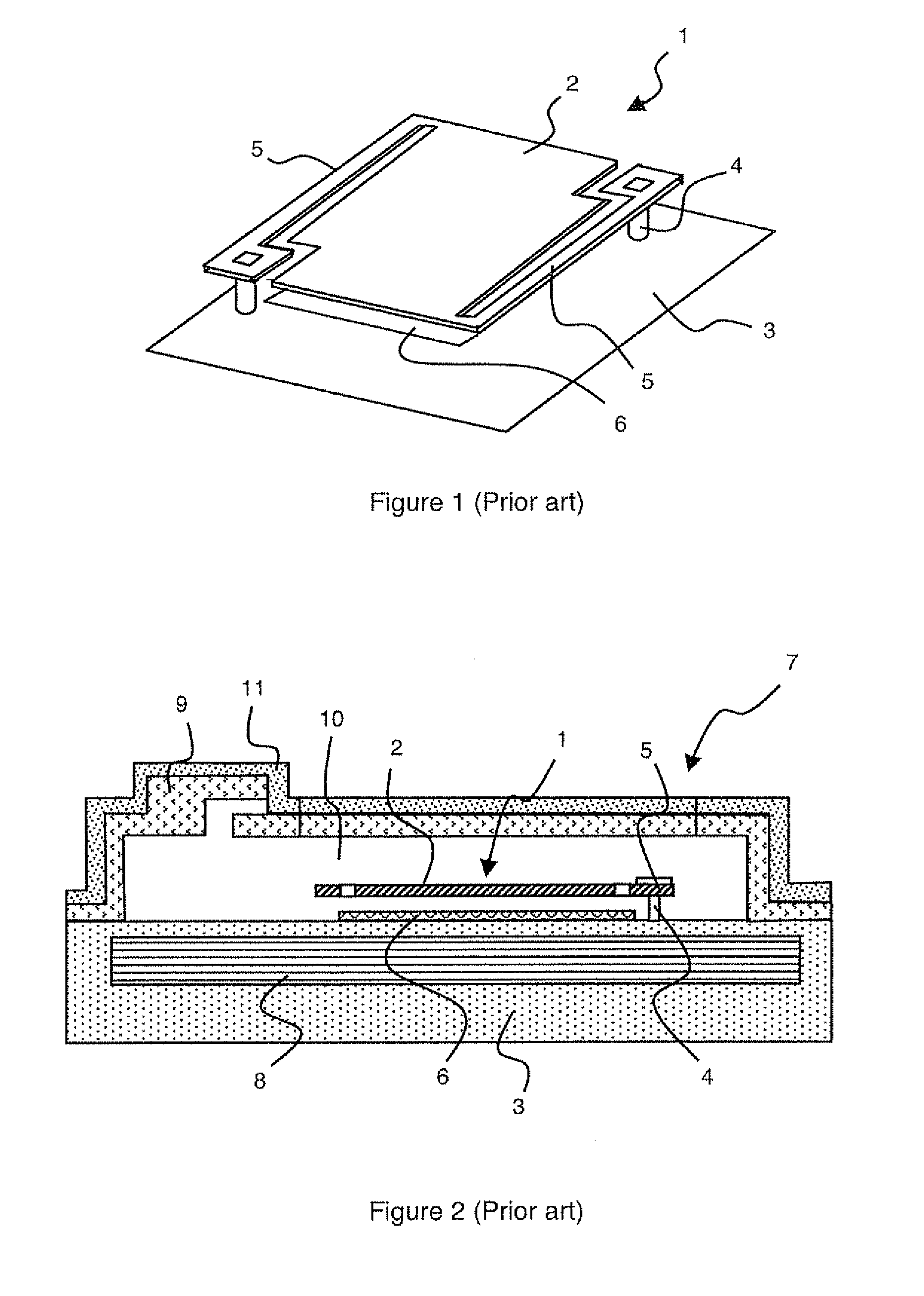

Device for detection and/or emission of electromagnetic radiation and method for fabricating such a device

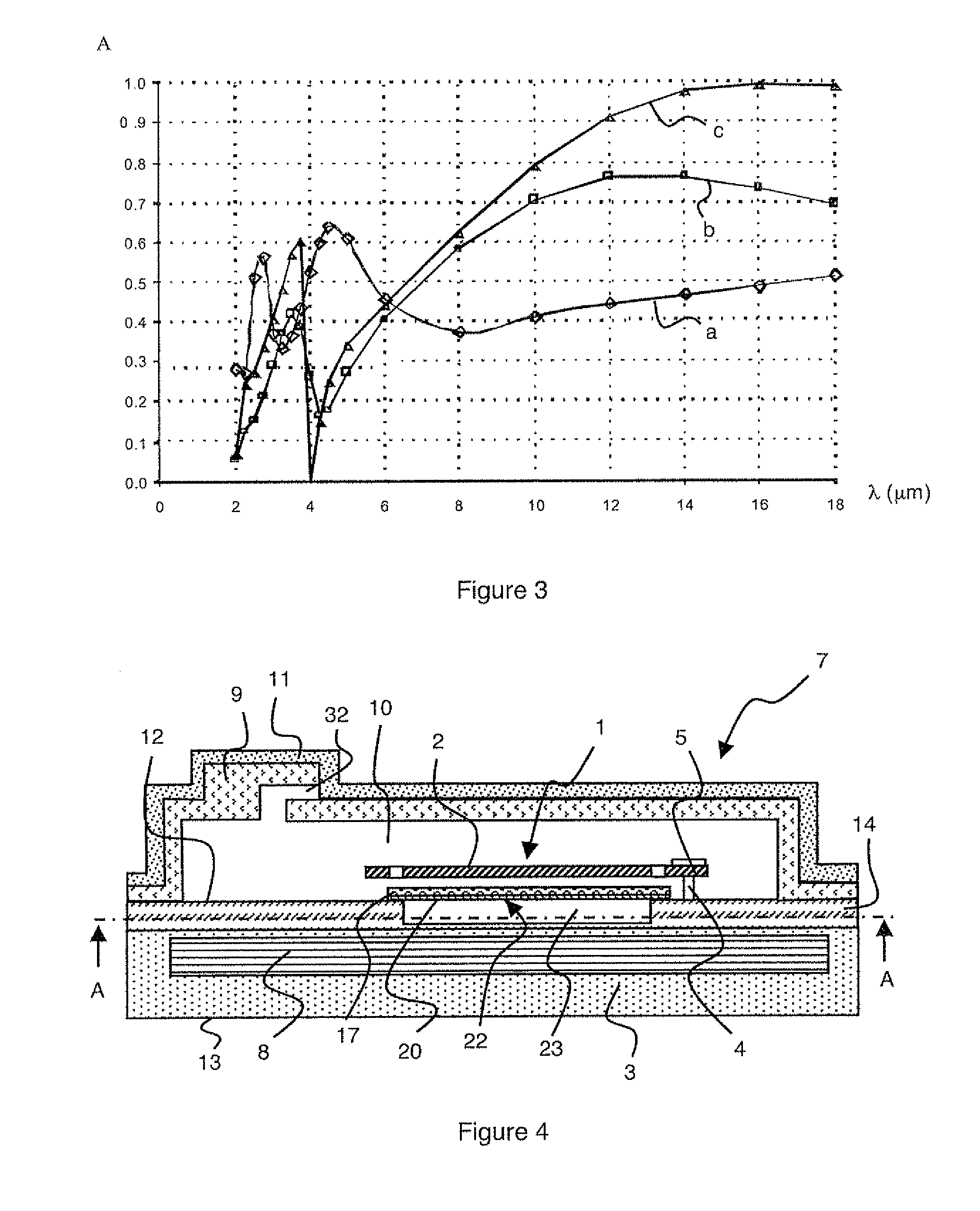

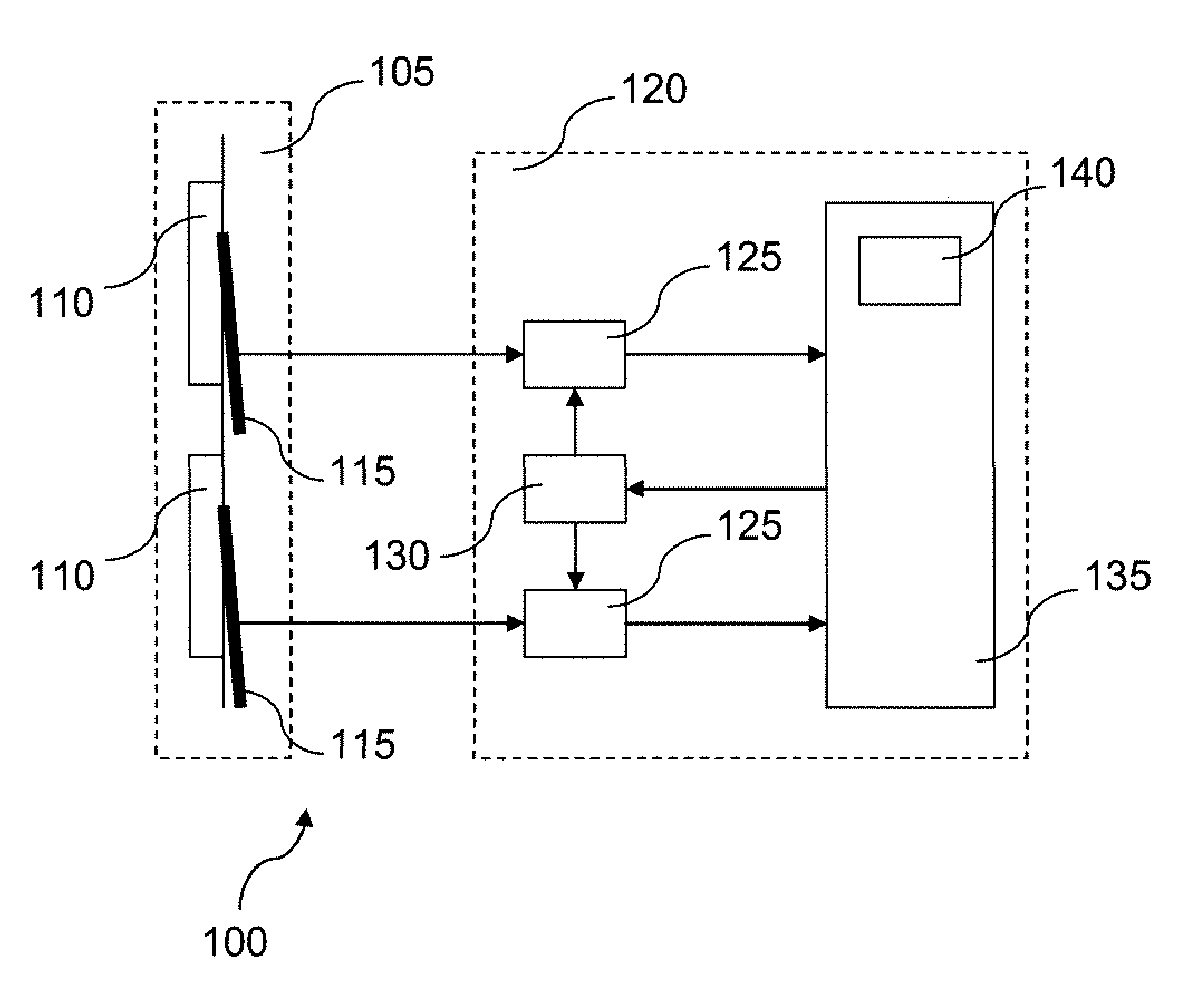

InactiveUS20100314544A1Simple to implementExtended service lifeSolid-state devicesSemiconductor/solid-state device manufacturingGetterRadiation

The device for detection and / or emission of radiation has an encapsulation micropackage in a vacuum or under reduced pressure that comprises a cap and a substrate delineating a sealed housing. The housing encapsulates at least one uncooled thermal detector and / or emitter having a membrane sensitive to electromagnetic radiation suspended above the substrate, a reflector and at least one getter. The getter is arranged on at least a part of a second main surface of the reflector to form a reflector / getter assembly. A free space, releasing an accessible surface of the getter and in communication with the housing, is also formed between the reflector / getter assembly and the front surface of the substrate.

Owner:COMMISSARIAT A LENERGIE ATOMIQUE ET AUX ENERGIES ALTERNATIVES

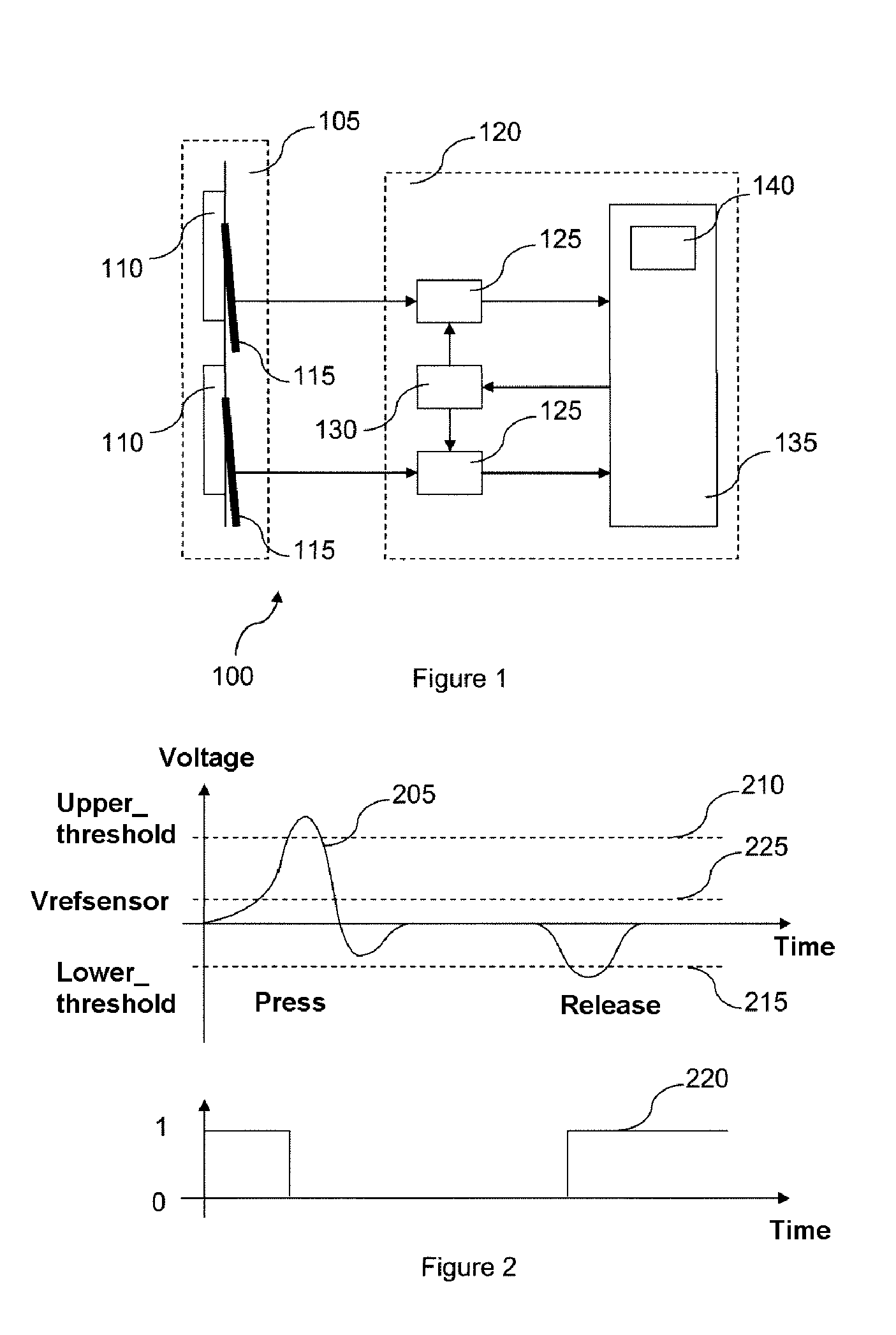

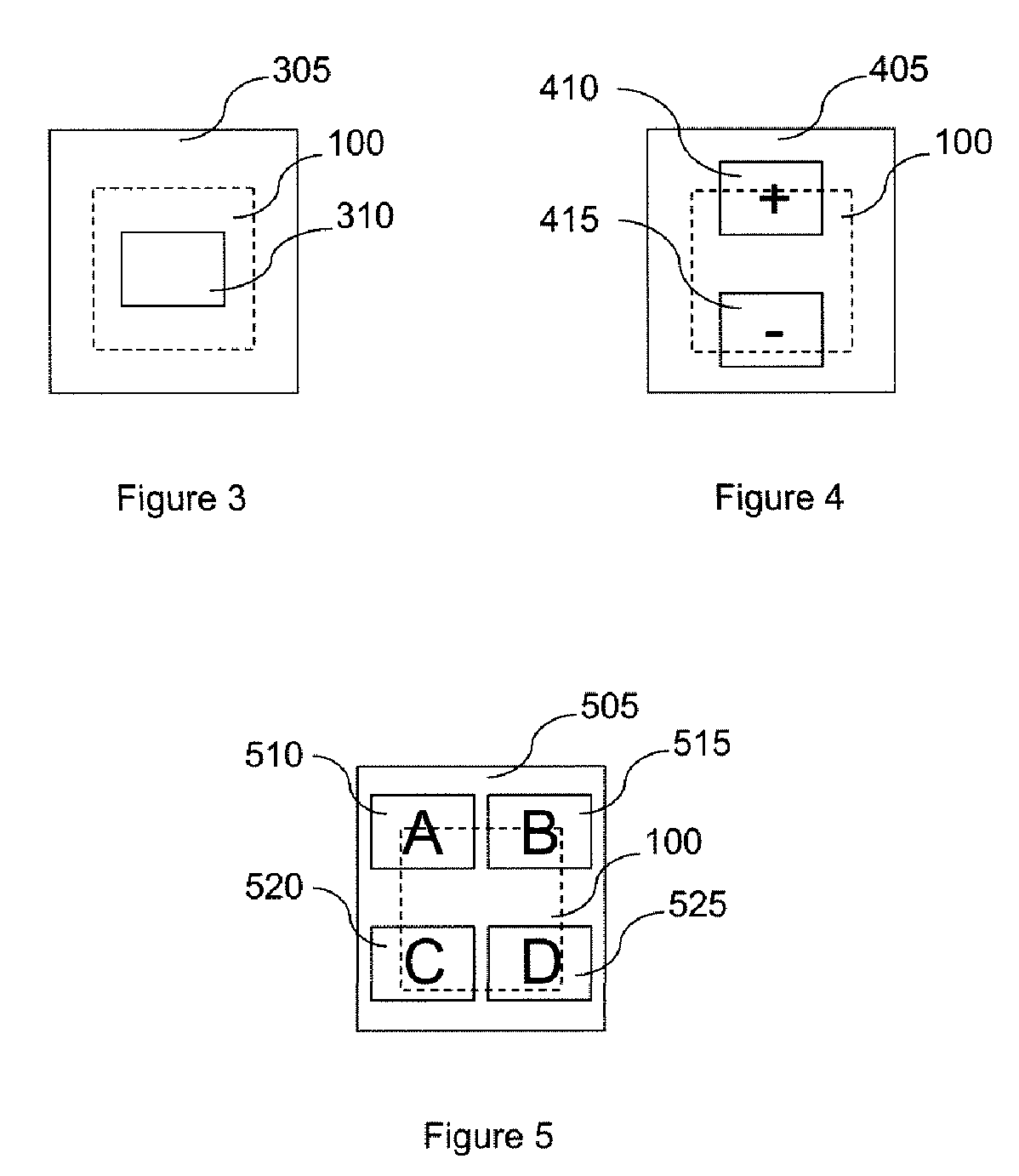

Touch-sensitive interface device and method

InactiveUS20090207147A1Simple to implementLow costEnergy efficient ICTDigital data processing detailsPeak valueElectricity

A touch-sensitive interface device includes:—a touch-sensitive keypad including elements for generating a voltage as the effect of a mechanical deformation, and—a signal processing electronic interface adapted to detect pressing and / or releasing of a voltage generator elements and to go to standby after the pressing and / or the releasing of each voltage generator elements. The voltage generator elements preferably includes a piezoelectric element. In embodiments, the electronic interface includes at least one voltage comparator device, the generation of a parameterable threshold voltage to which the voltage comparator device compares the voltage at the terminals of a voltage generator element, and a card including a central processor unit and its power supply unit. The parameterable threshold voltage can be increased or decreased to detect positive and negative peaks of at least one voltage generator elements respectively caused by pressing or releasing at least one voltage generator elements.

Owner:LEGRAND SNC

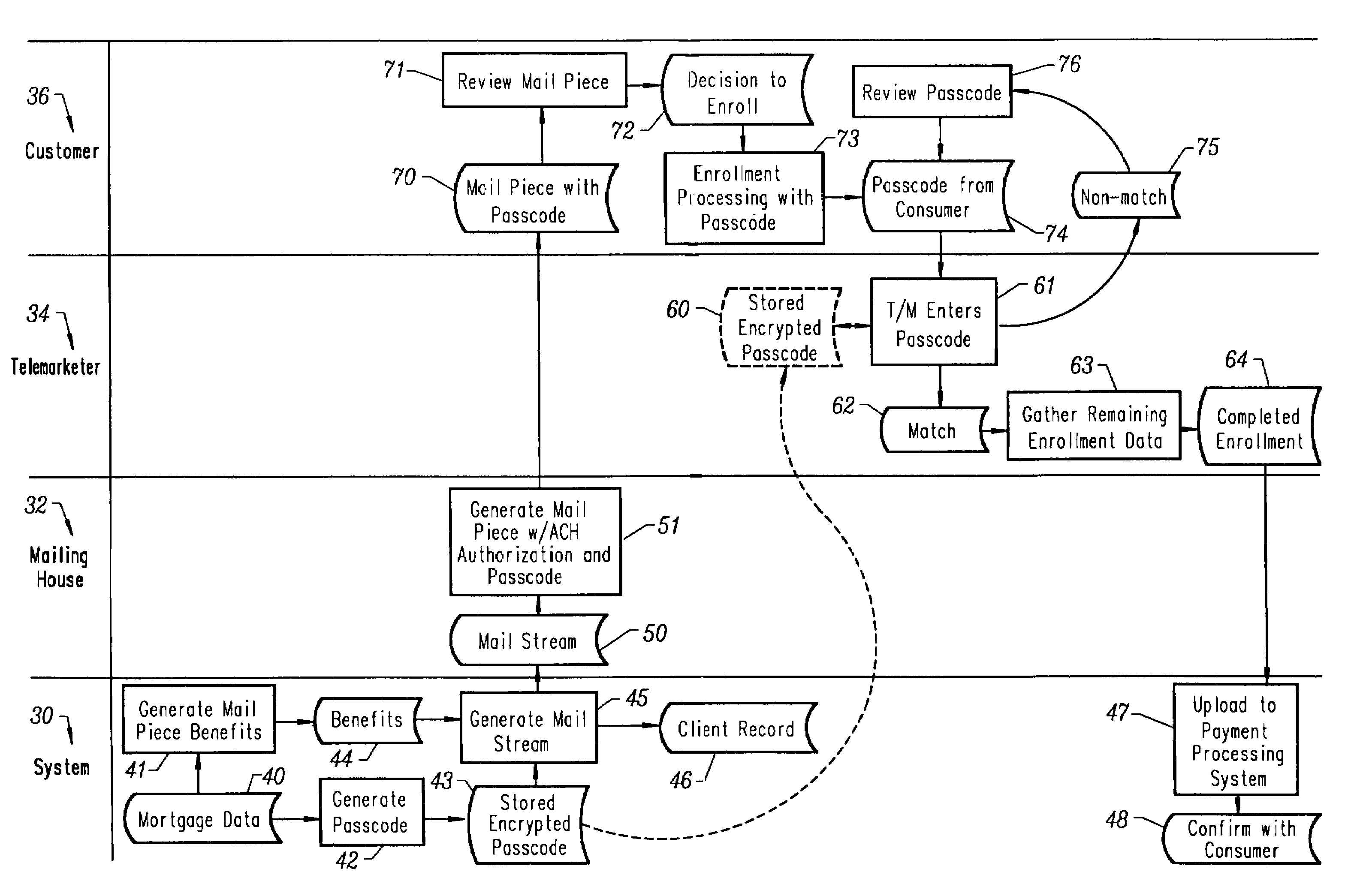

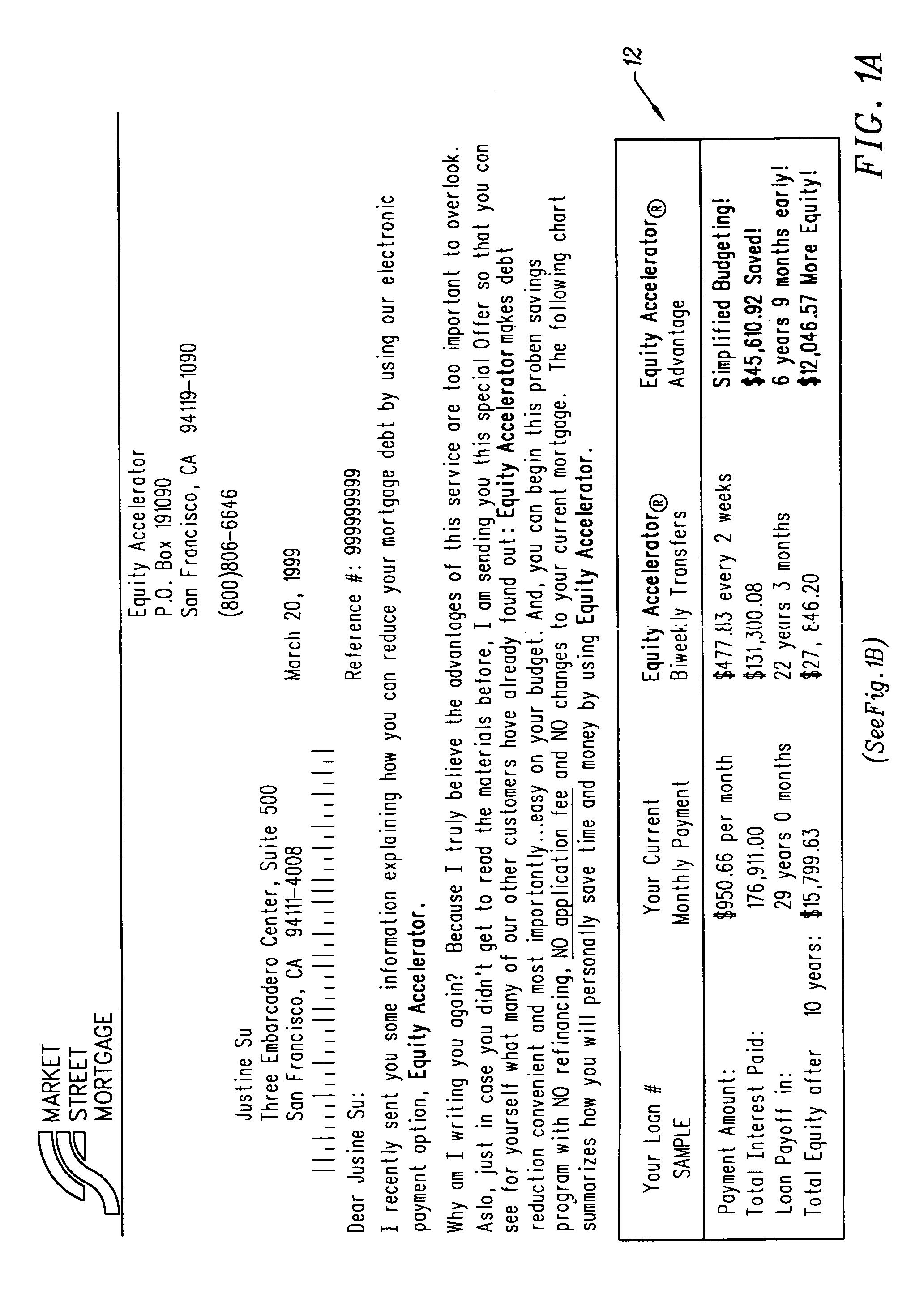

Method and apparatus for preauthorizing electronic fund transfers without actual written authentication

A method and apparatus for preauthorizing electronic fund transfers from a consumer's bank account without obtaining actual written authentication from the consumer is implemented in connection with a direct marketing strategy for a financial product which, in the presently preferred embodiment of the invention, is a mortgage acceleration program. The invention provides for the mailing of a solicitation to a consumer, i.e. a prospective customer, based upon such factors as mortgage data that the financial institution may posses concerning the consumer. The mailing includes an authorization and passcode which, in the presently preferred embodiment of the invention, is an ACH authorization and passcode. When the consumer receives the solicitation, he may decide to enroll in the mortgage acceleration program. The consumer places a telephone call to a telemarketing organization at a telephone number that accompanied the solicitation. The consumer provides the passcode to a representative of the telemarketing organization and the telemarketing organization attempts to verify the passcode. If the passcode is successfully verified, then the consumer is enrolled in the mortgage acceleration program. Thus, the invention provides a deceptively simple and specific implementation of the “similarly authenticated” requirement of the EFTA that is applicable to direct marketing solicitations made by, or on behalf of, financial institutions. That is, the passcode provided by the consumer meets the requirement of a “digital signature or other code.” Yet, the consumer is not required to provide an actual written signature, nor is the consumer required to use a computer or other electronic means to conclude the transaction.

Owner:PAYMAP +1

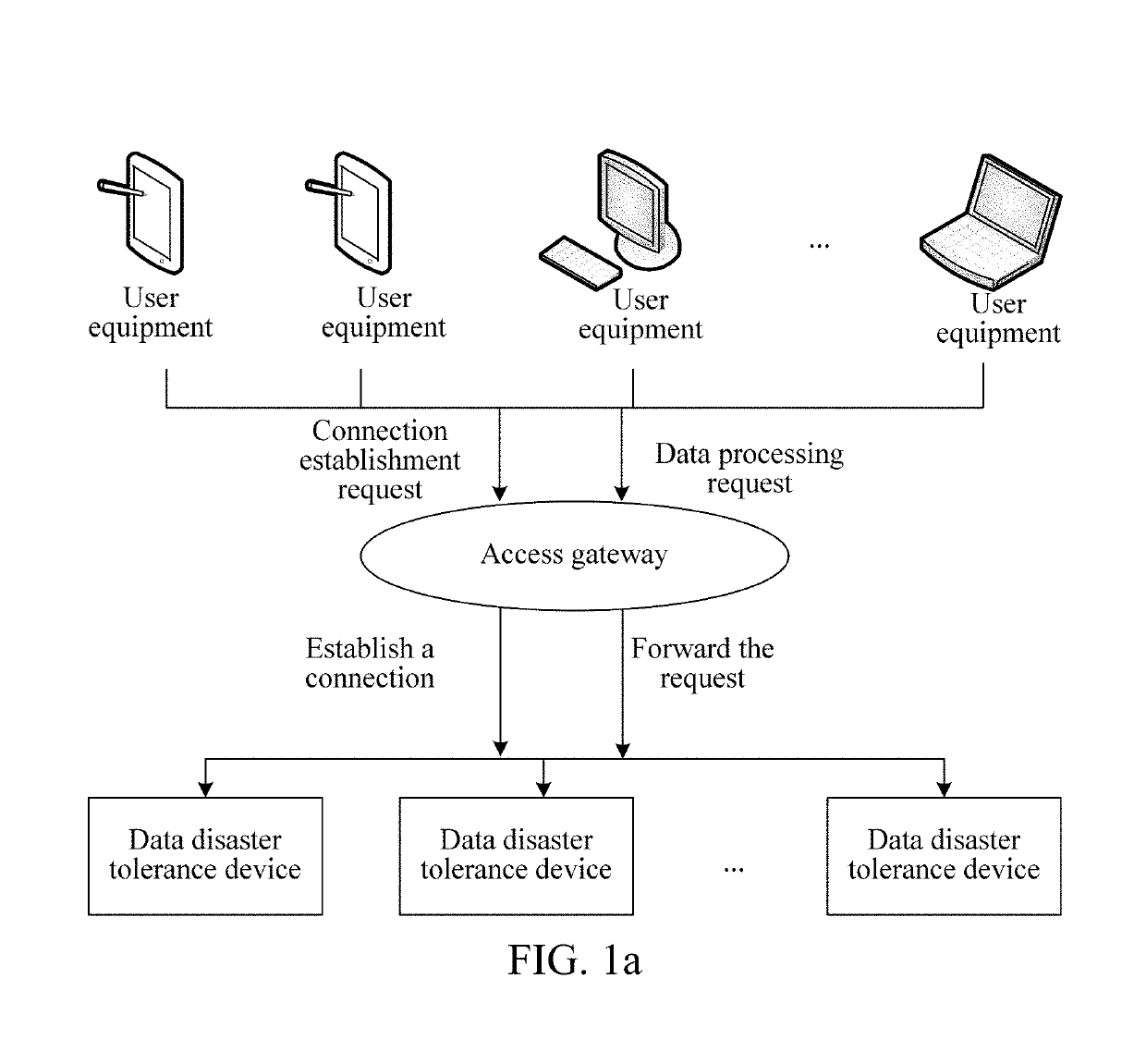

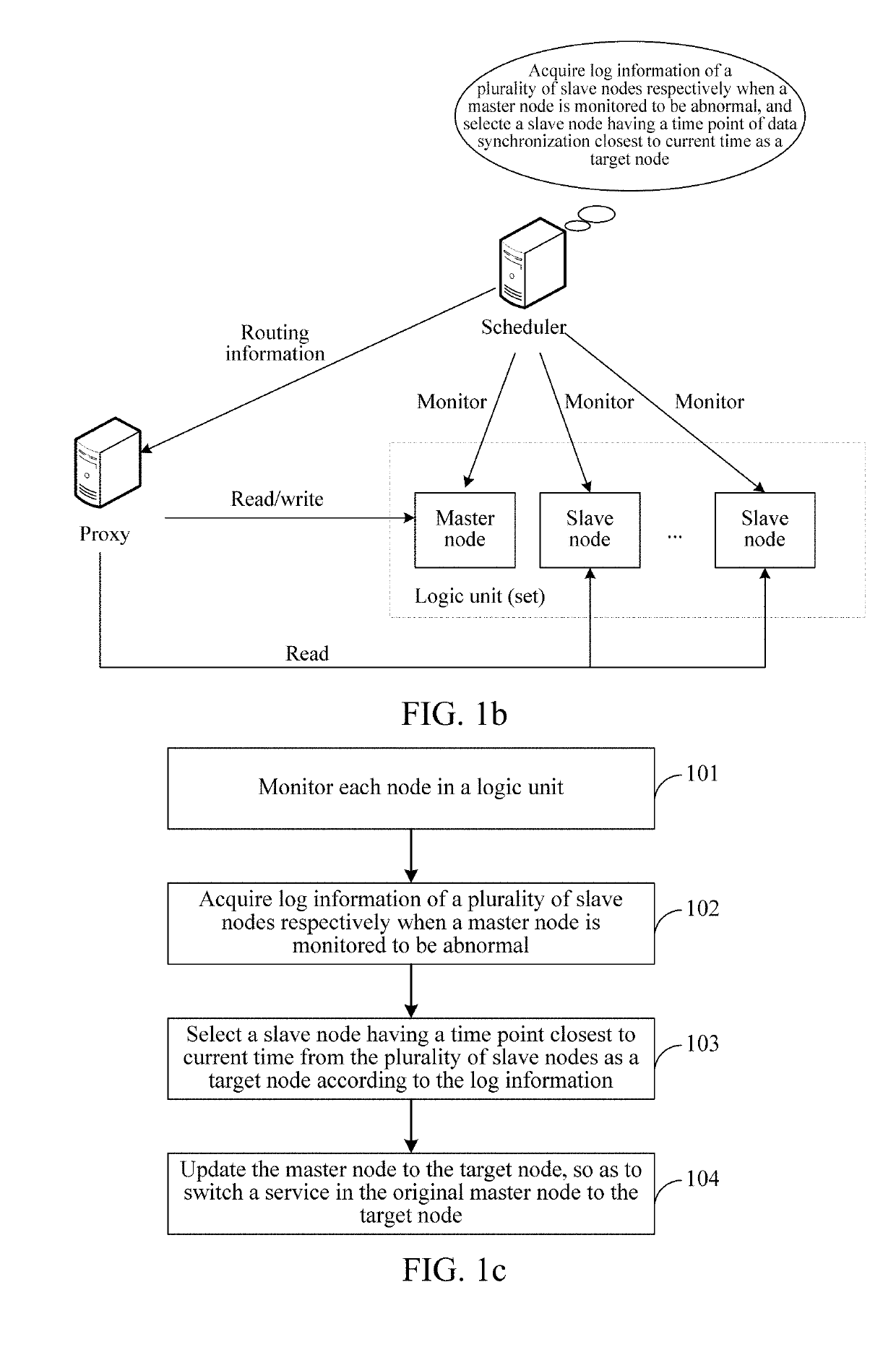

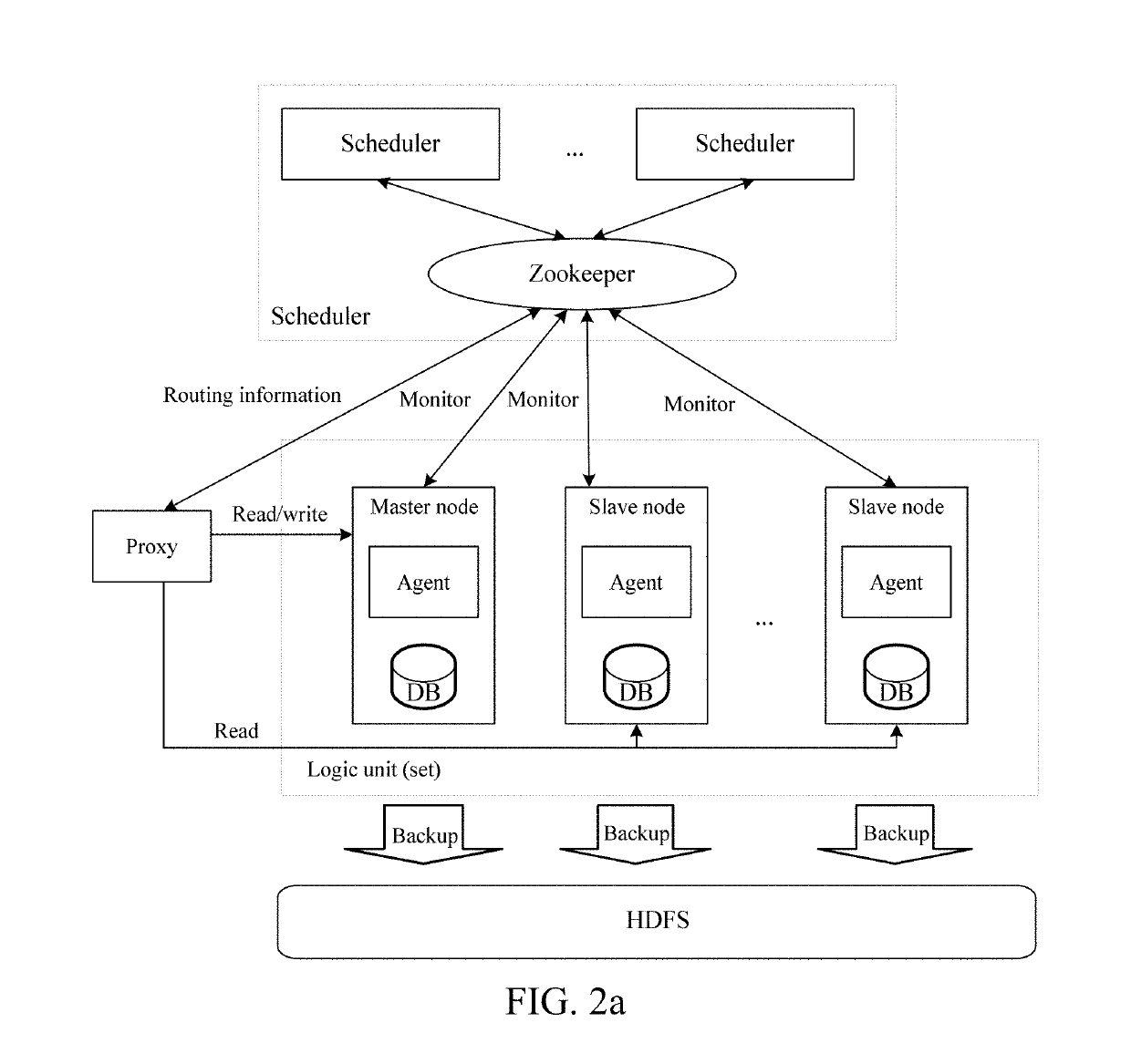

Data disaster recovery method, device and system

ActiveUS20190095293A1Simple to implementHigh availability of systemNon-redundant fault processingTransmissionCurrent timeReal-time computing

A data disaster tolerance method, device and system is disclosed. Each node in a logic unit including a single master node and two or more slave nodes is monitored. If the master node is abnormal, the server acquires log information of the plurality of two or more slave nodes separately, the log information of the two or more slave nodes includes respective time points of data synchronization between the slave nodes and the master node A respective slave node of the two or more slave nodes having the time point of data synchronization closest to a current time is selected as a target node. A master-slave relationship in the logic unit is updated to change a role of the target node to that of the master node.

Owner:TENCENT TECH (SHENZHEN) CO LTD

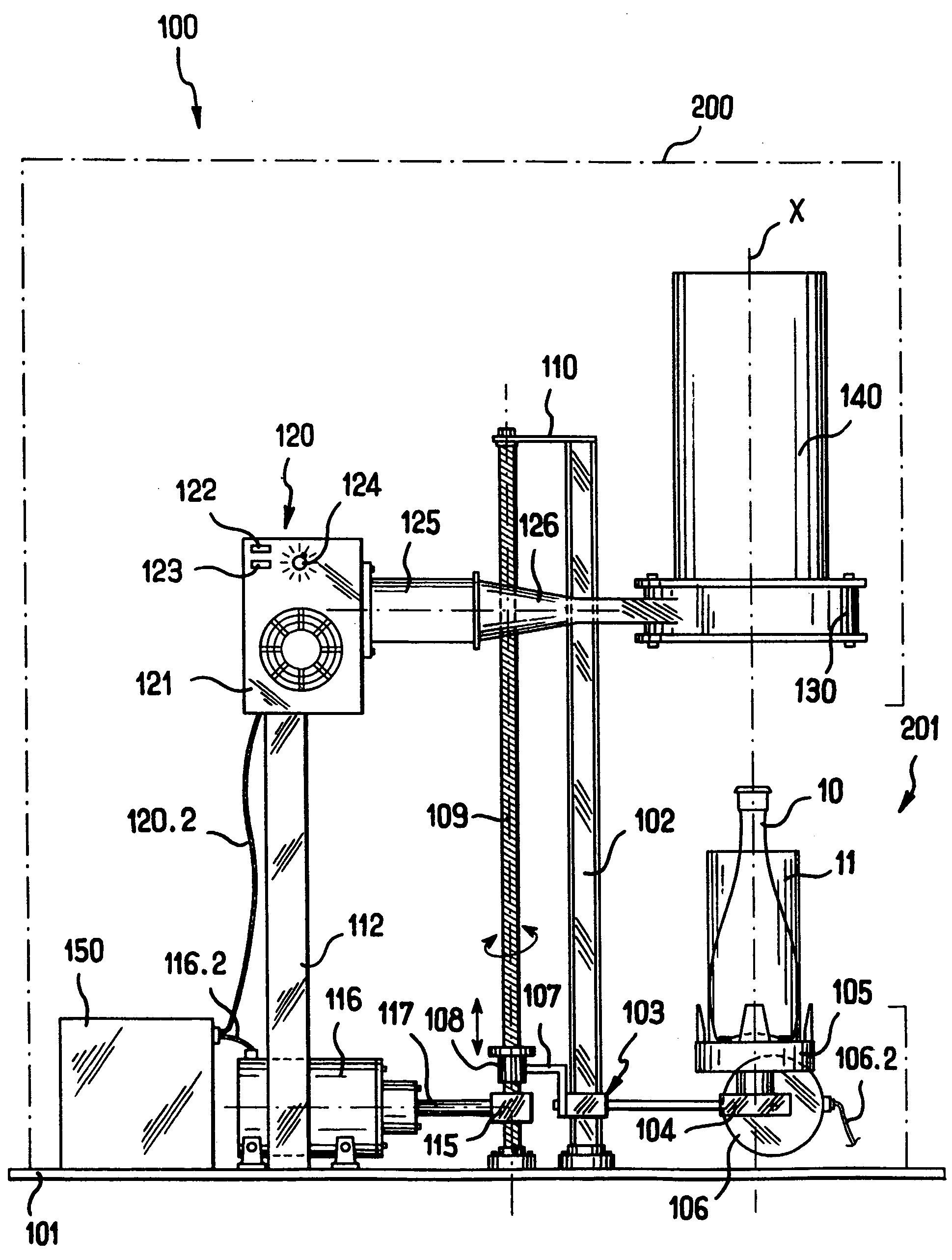

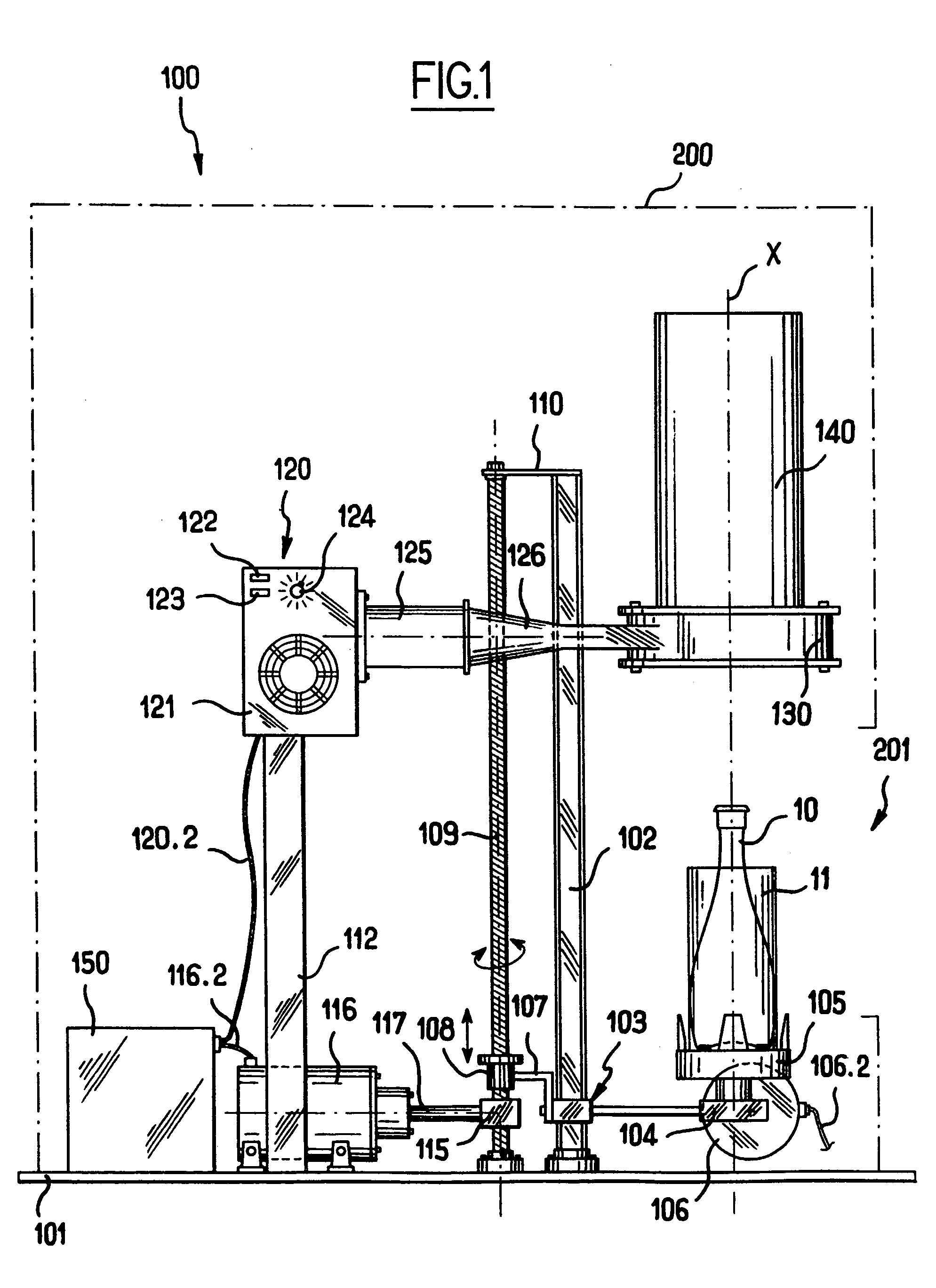

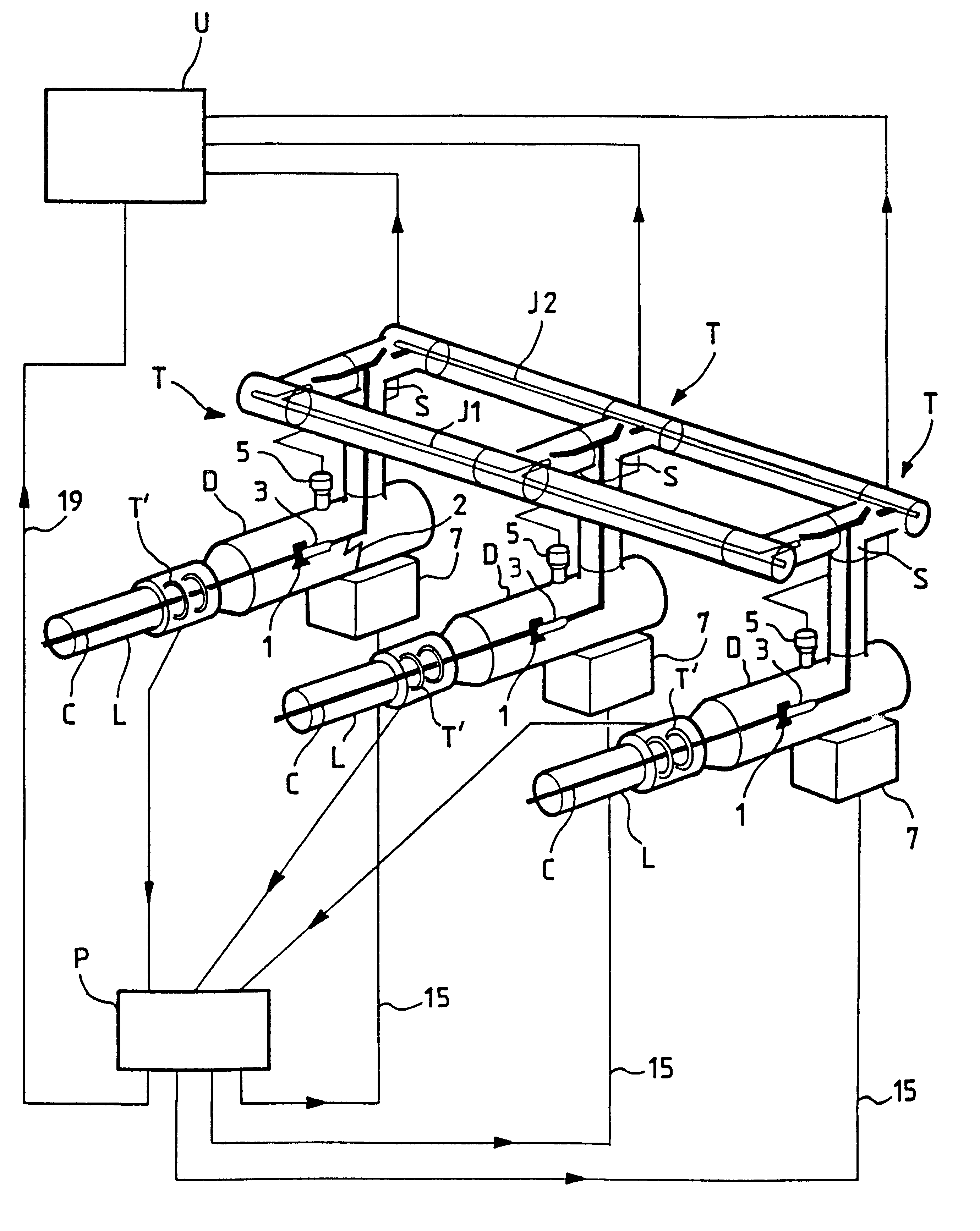

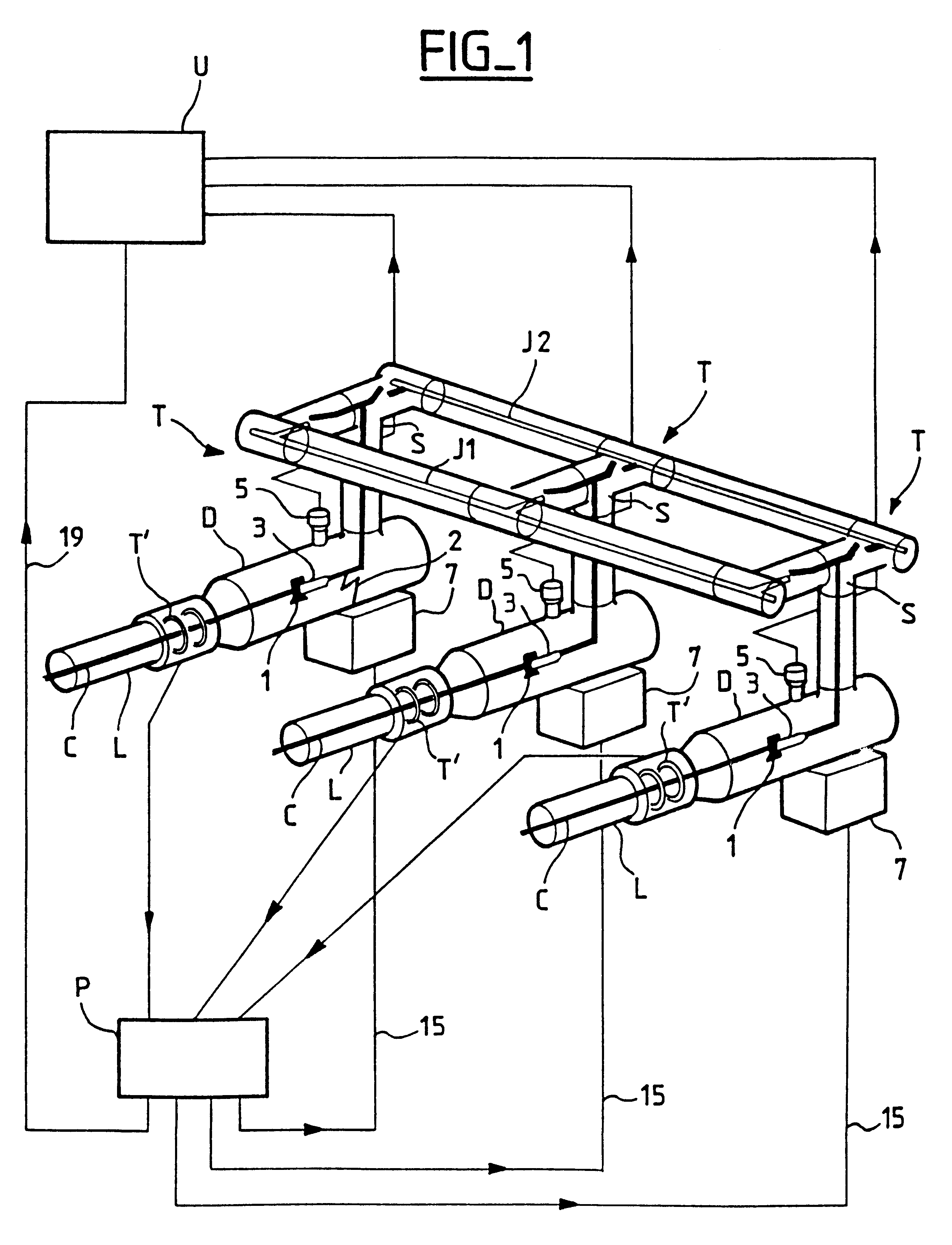

Method and a machine for heat-shrinking heat-shrink sleeves engaged individually on articles such as bottles

ActiveUS20050022469A1Simple to implementEasy to implementWrappers shrinkageDrying using combination processesEngineeringPlastic film

The present invention relates to a method and to a machine for heat-shrinking sleeves made from a film of heat-shrink plastics material and engaged individually on articles such as bottles. In accordance with the invention, the machine comprises a fixed structure, an article support arranged to move along a vertical central axis between a low position in which articles can be put into place or removed, and a high position in which an article is fully received in a pre-heater chamber surmounting a shrinkage chamber, together with a controller governing parameters of temperature, support travel speed, and time, during the operating sequences of the method. This enables ordinary consumers themselves to cause sleeves to be shrunk onto bottles.

Owner:SLEEVER INT

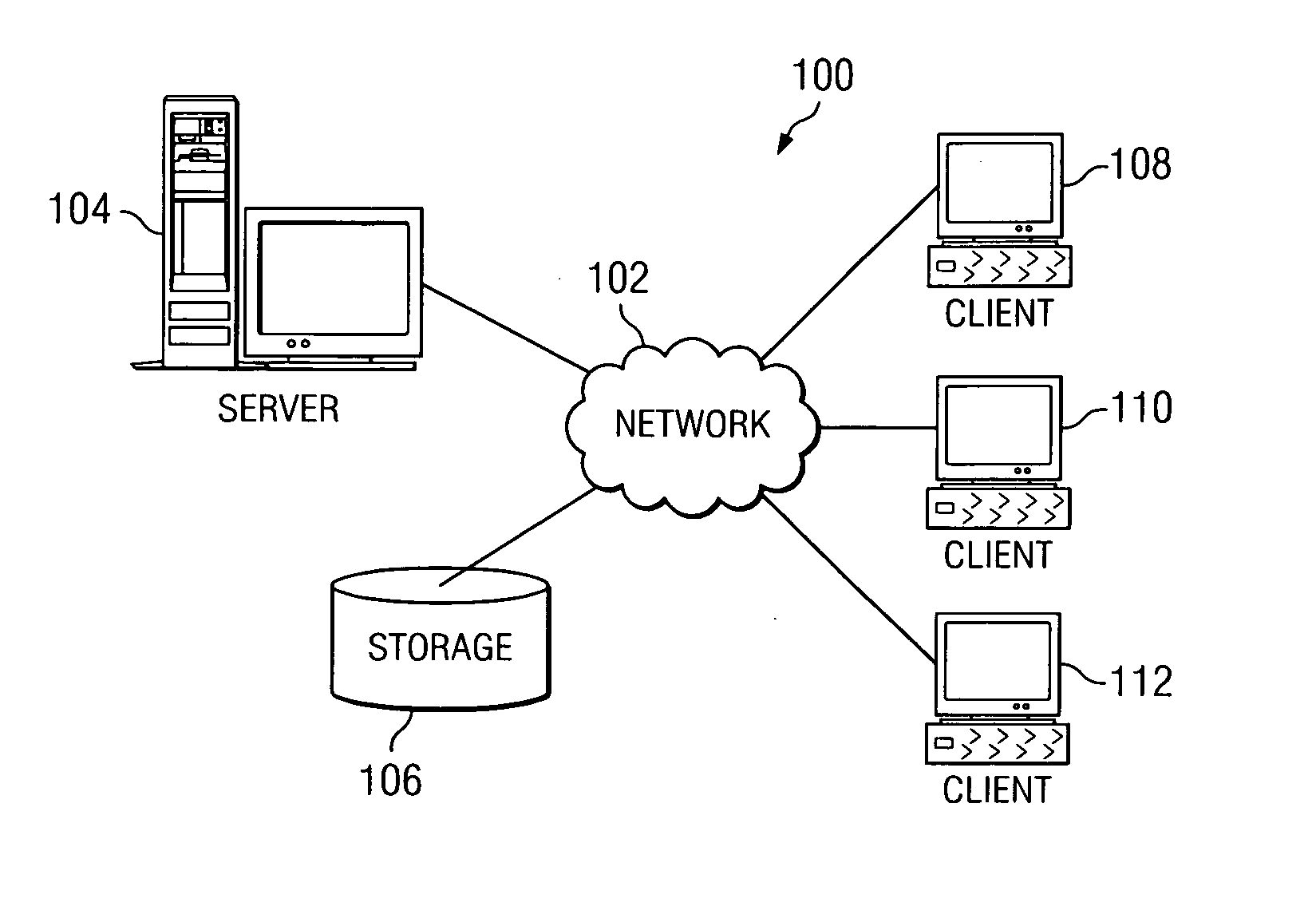

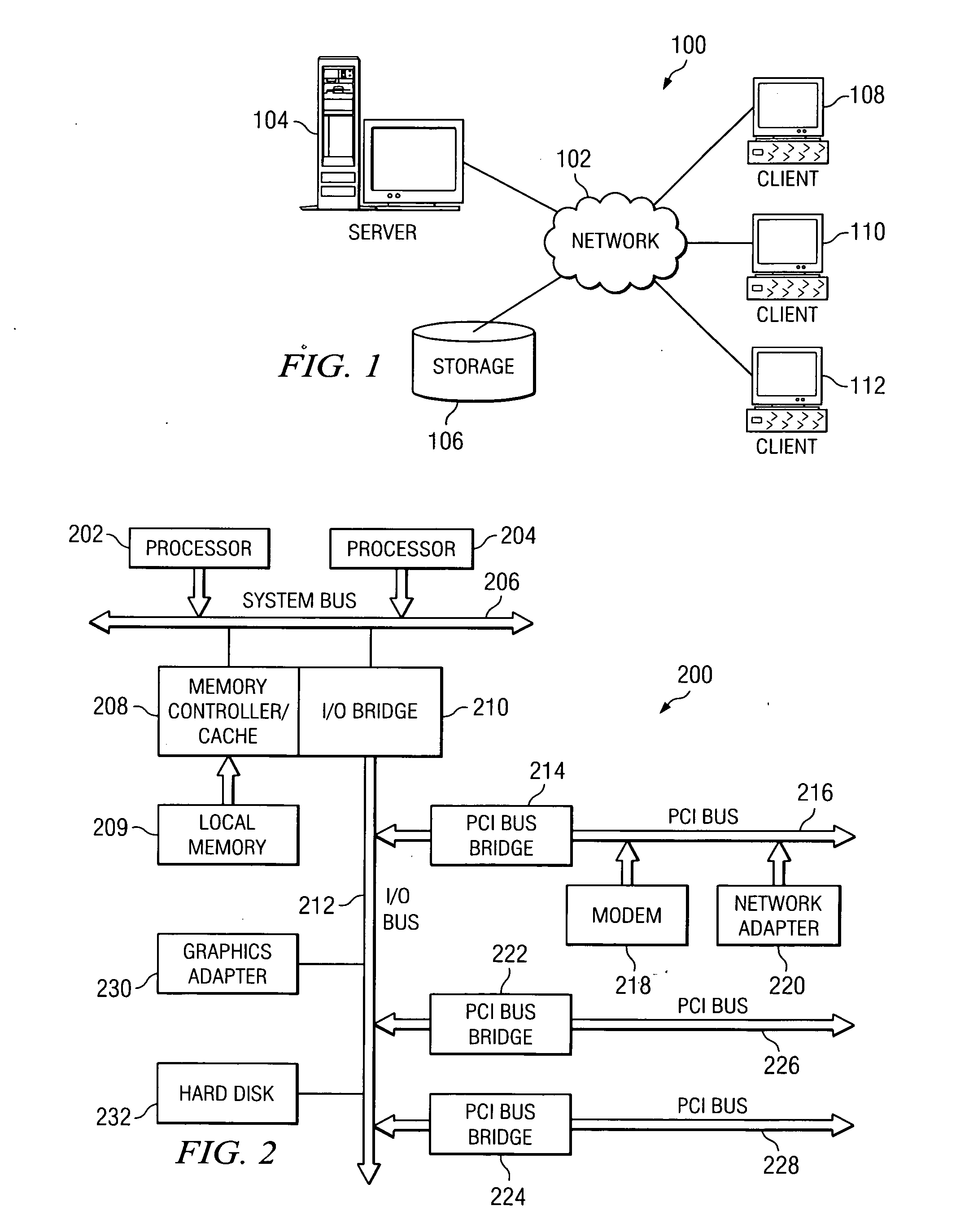

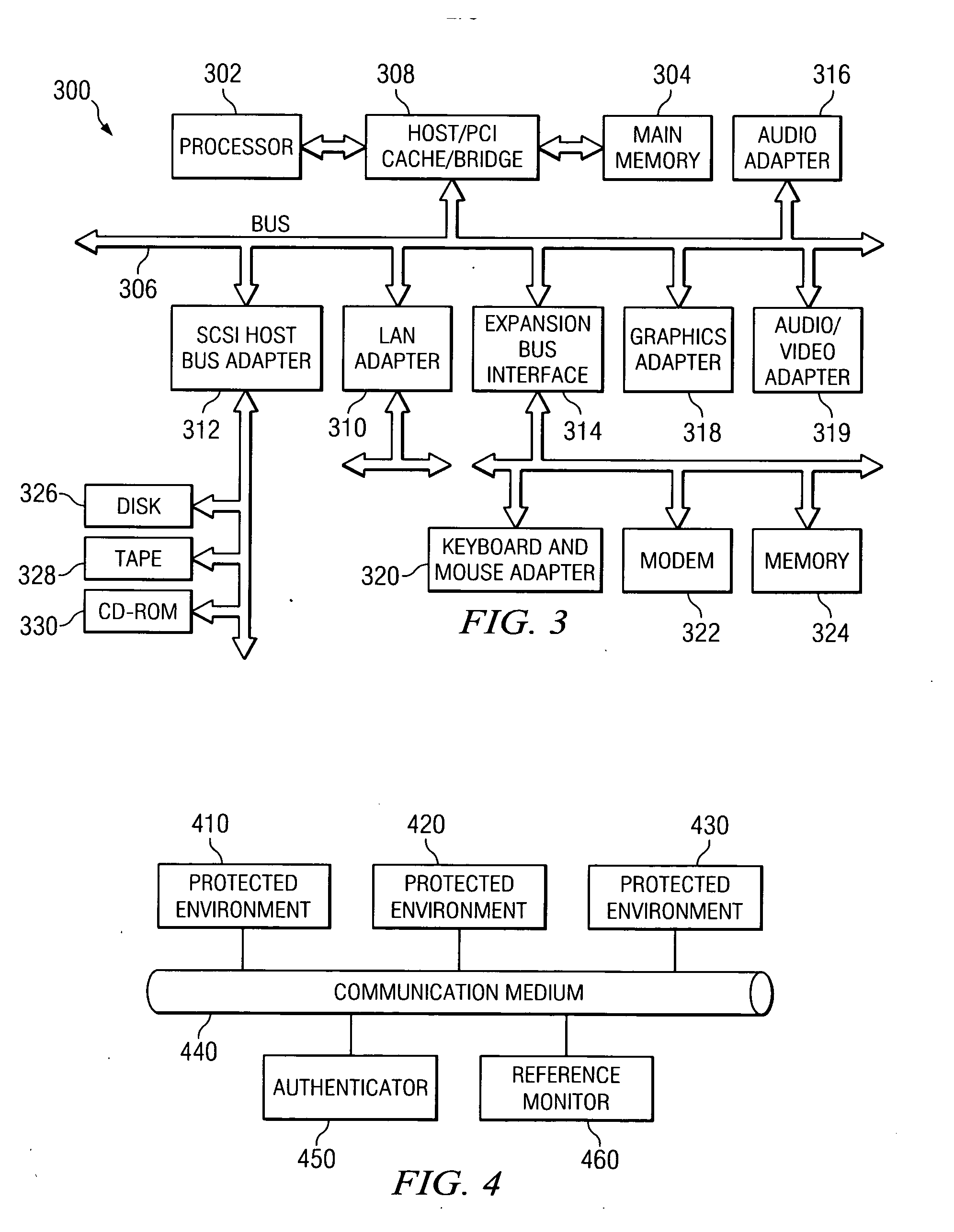

Reference monitor system and method for enforcing information flow policies

InactiveUS20070143604A1Simple to implementComplicate applicationDigital data processing detailsUnauthorized memory use protectionSecurity policyData processing

A reference monitor system, apparatus, computer program product and method are provided. In one illustrative embodiment, elements of the data processing system are associated with security data structures in a reference monitor. An information flow request is received from a first element to authorize an information flow from the first element to a second element. A first security data structure associated with the first element and a second security data structure associated with the second element are retrieved. At least one set theory operation is then performed on the first security data structure and the second security data structure to determine if the information flow from the first element to the second element is to be authorized. The security data structures may be labelsets having one or more labels identifying security policies to be applied to information flows involving the associated element.

Owner:IBM CORP

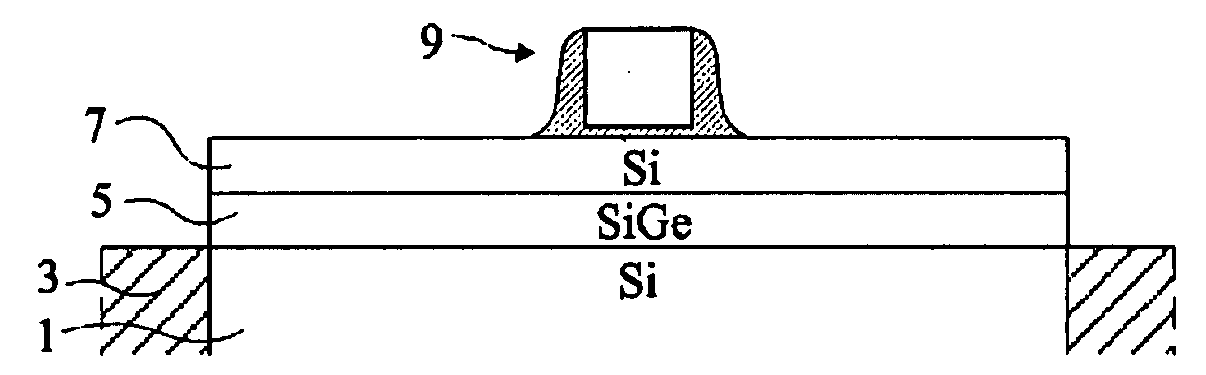

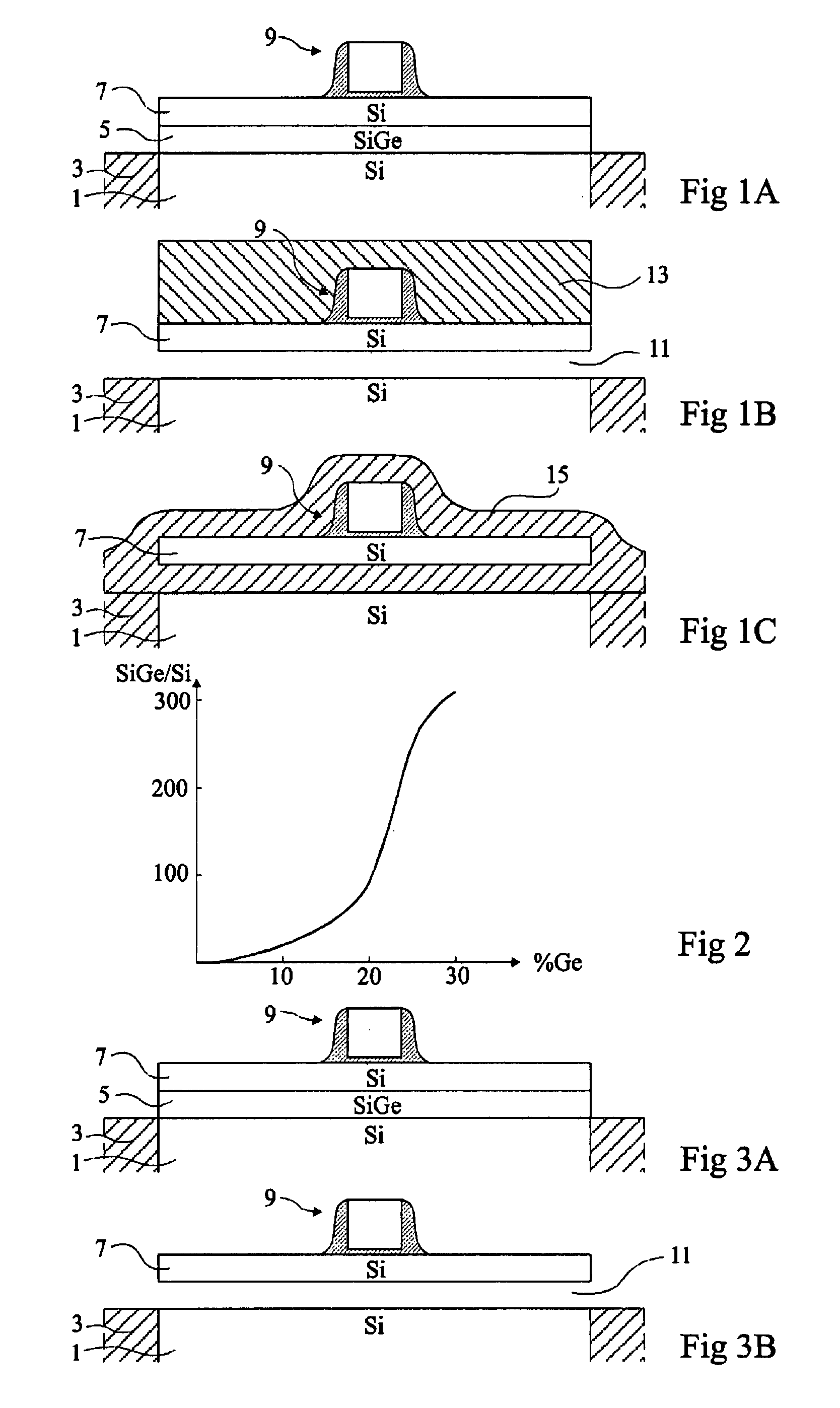

Method for etching silicon-germanium in the presence of silicon

ActiveUS20070190787A1Simple to implementEasy to implementSemiconductor/solid-state device manufacturingMonocrystalline siliconCompound (substance)

Owner:STMICROELECTRONICS SRL

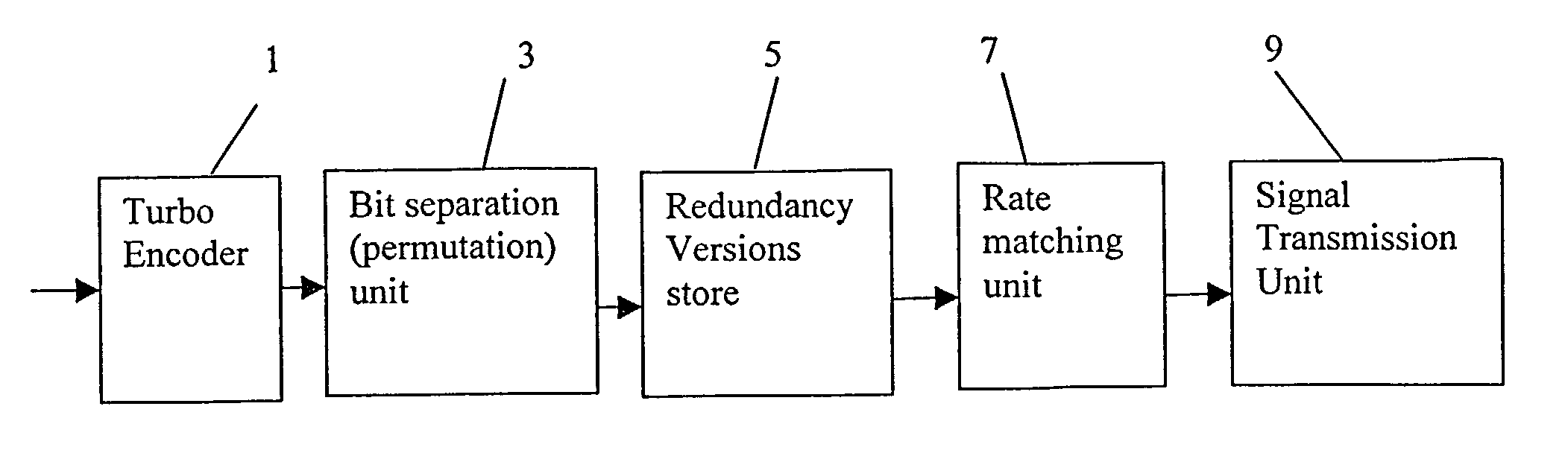

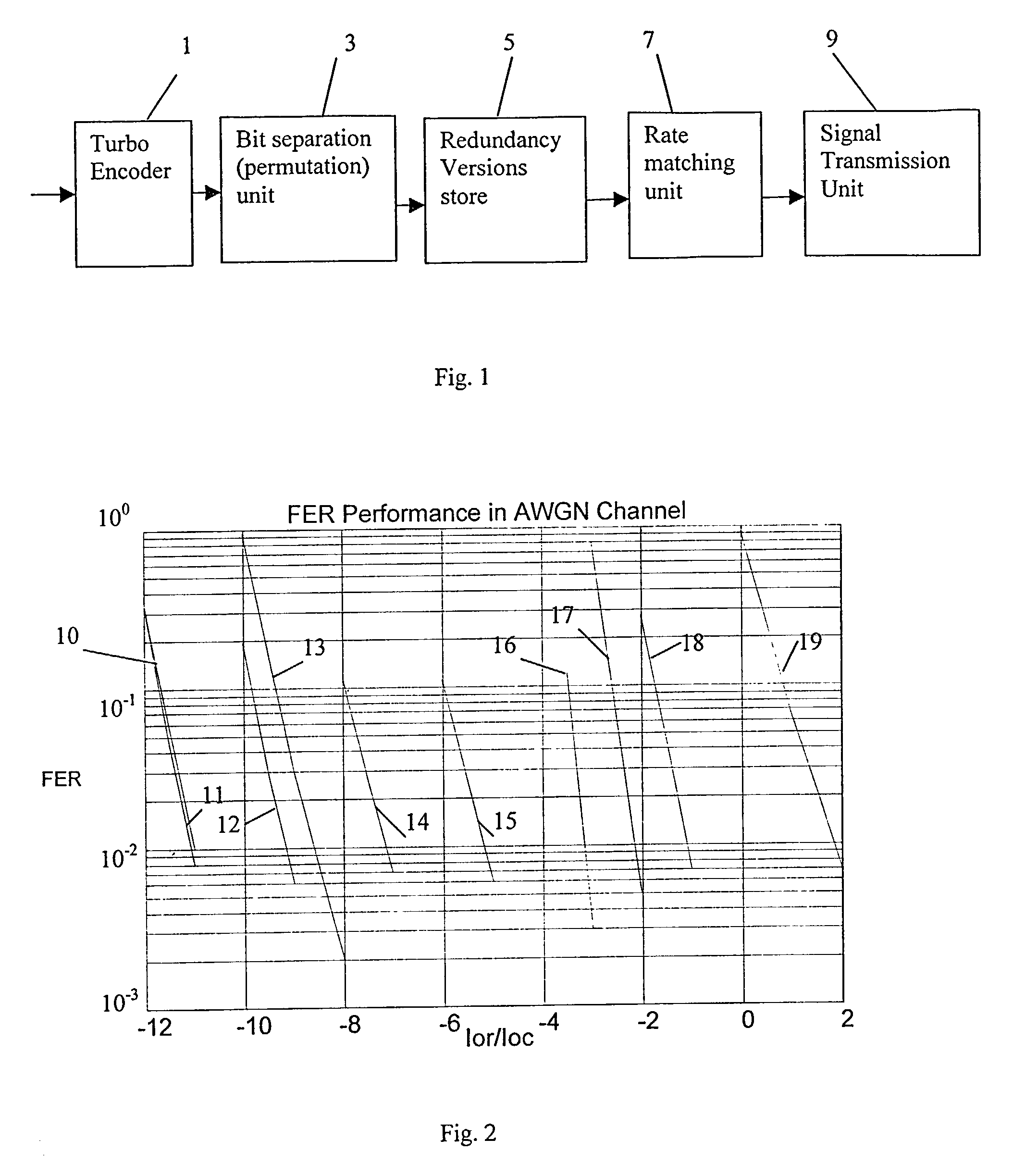

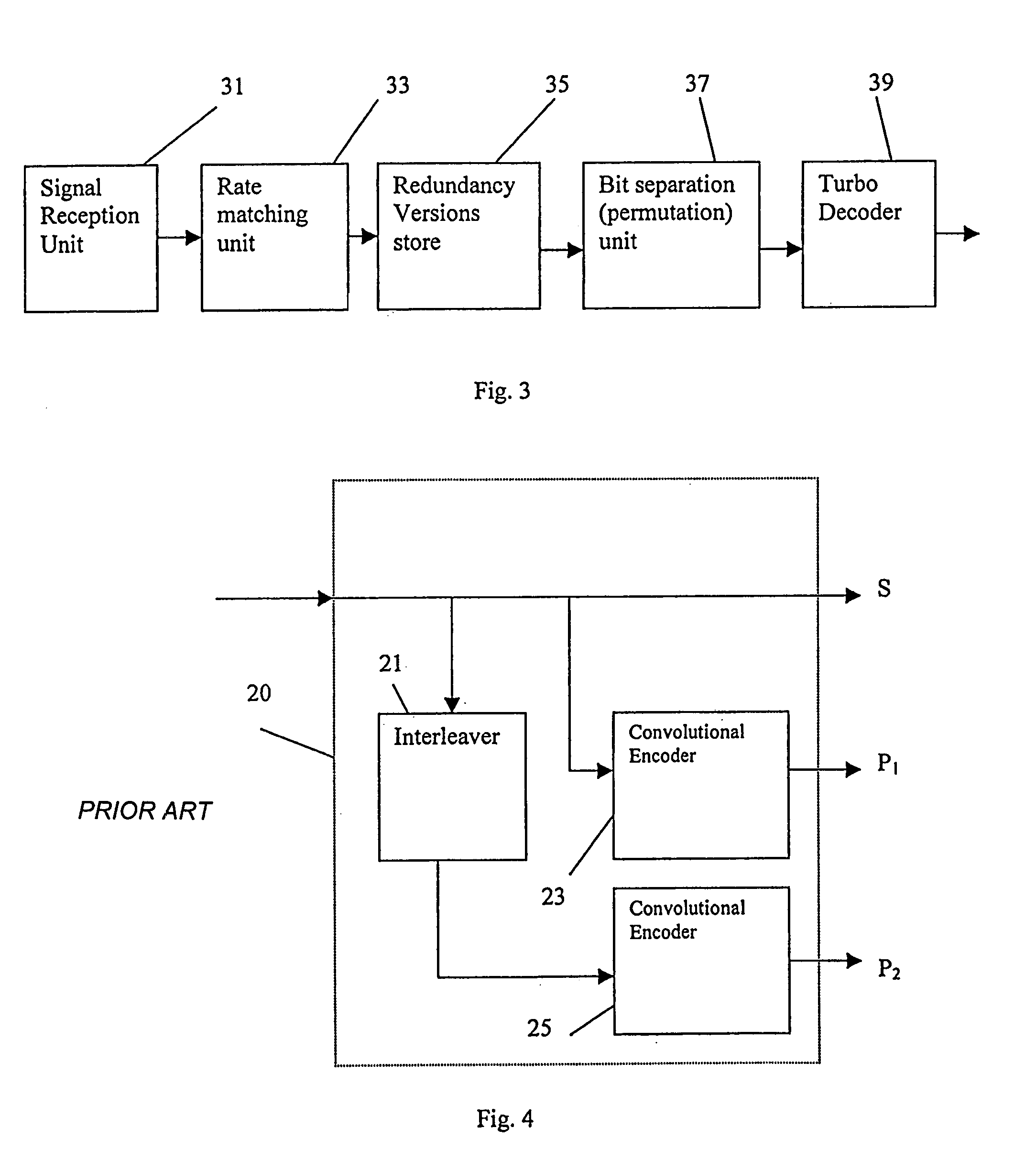

Communication system employing turbo codes and a hybrid automatic repeat request scheme

ActiveUS7210089B2Good performanceSimple to implementError prevention/detection by using return channelData representation error detection/correctionIncremental redundancyCode rate

A communications system employs a HARQ method and, for at least some transmission formats, incremental redundancy (IR) signals. For such formats, the multiple IR signals are derived from a single turbo encoded signal by forming multiple permutations of the encoded signal. The permutations are then converted to the coding rate of the selected transmission format. It is demonstrated by simulation that the present proposal achieves a better performance than the known HARQ techniques, while its implementation is simpler. For certain transmission formats, the transmitted signal in response to a retransmission request is identical to the first transmitted signal.

Owner:WIPRO LTD

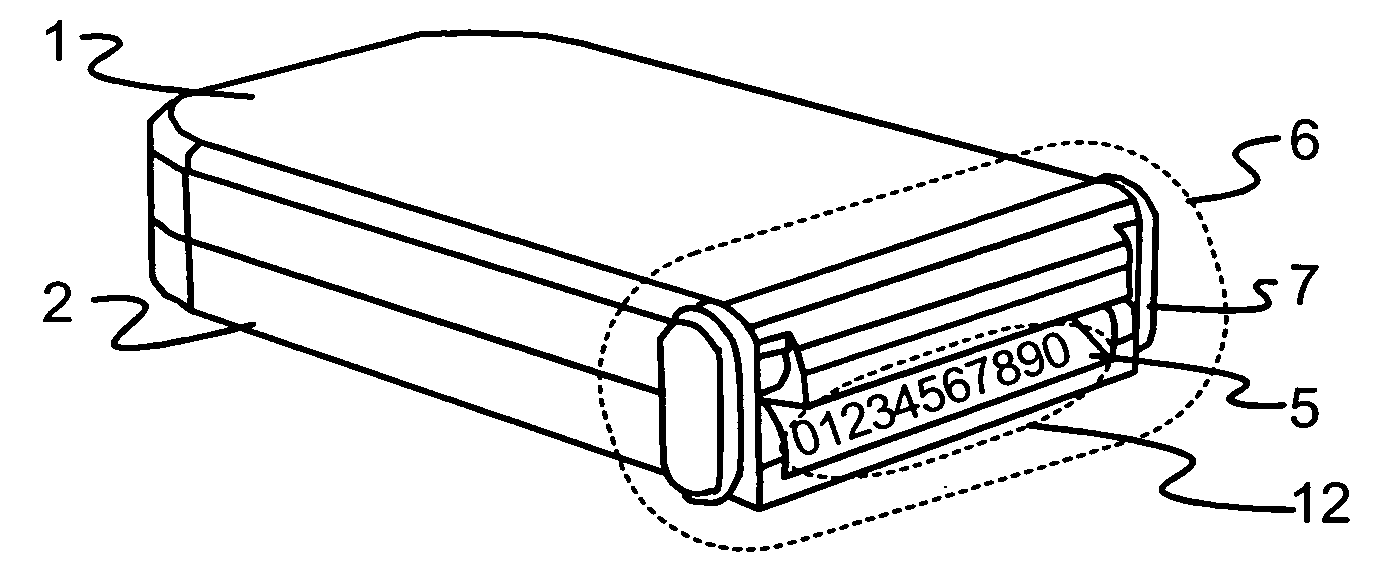

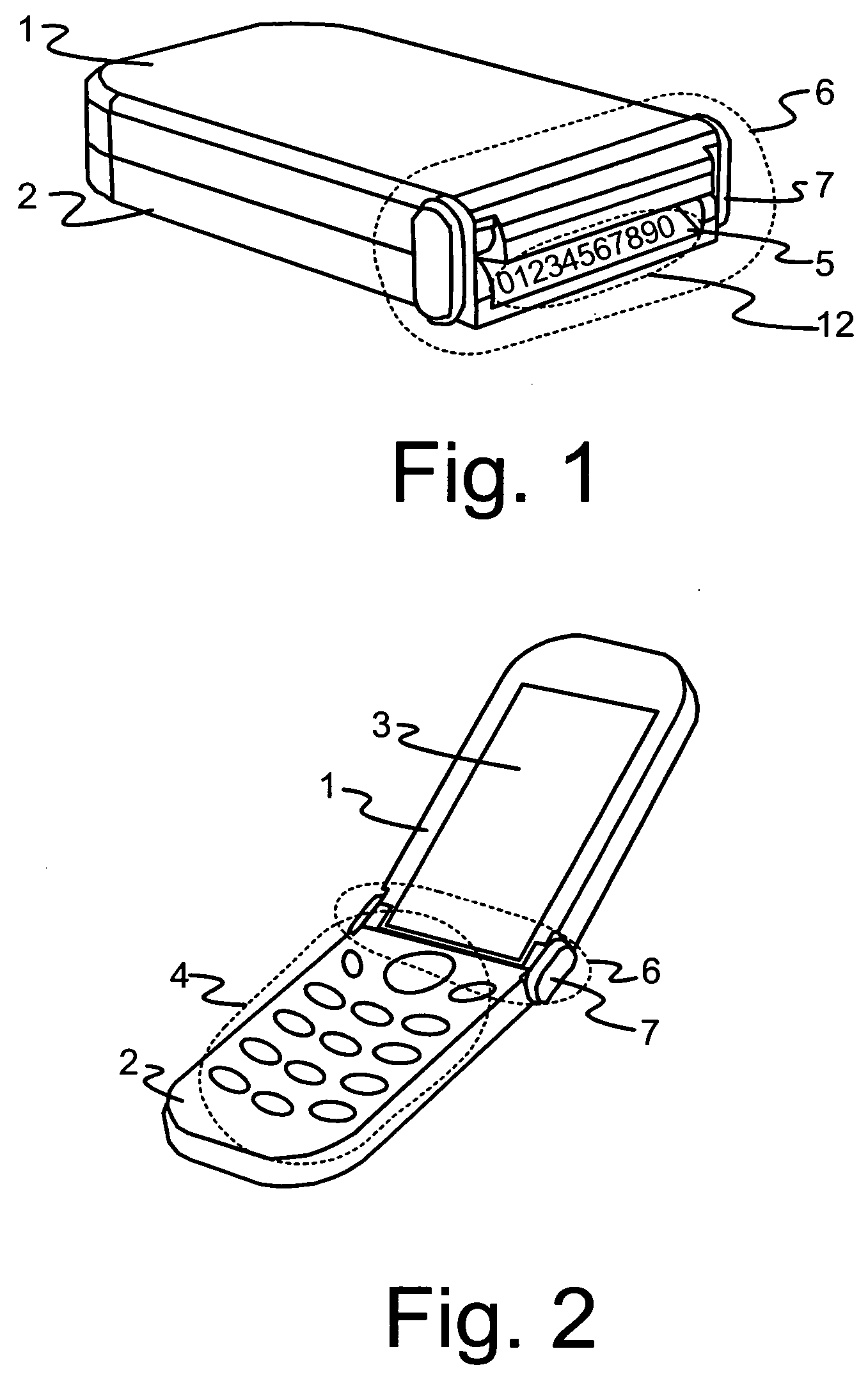

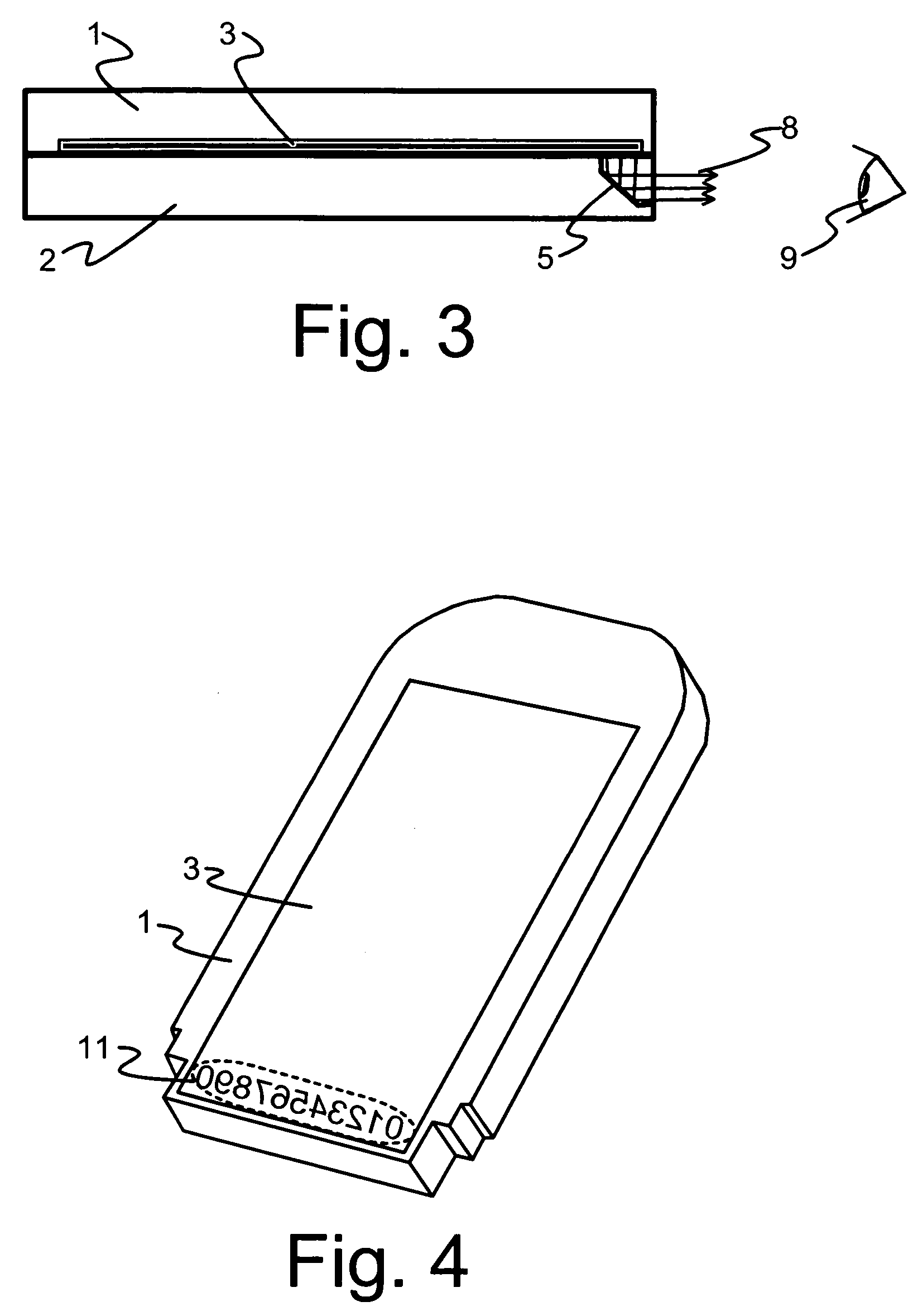

Sub-display of a mobile device

InactiveUS20060146011A1Simple to implementIntuitive displayDevices with multiple display unitsCathode-ray tube indicatorsControl equipmentComputer program

The invention relates to a mobile device, which comprises a first housing and a second housing, which housings are arranged movable in relation to each other to at least a first and a second position; the first housing comprising a primary display for displaying information and arranged to be visible for a user at least in the first position; the device further comprising a passive image steering element that is adapted to steer at least a part of the view of said primary display to become visible for the user as a secondary display in the second position. This invention also relates to a image steering module, a method in a mobile device and a computer program for controlling a user interface of a device.

Owner:NOKIA CORP

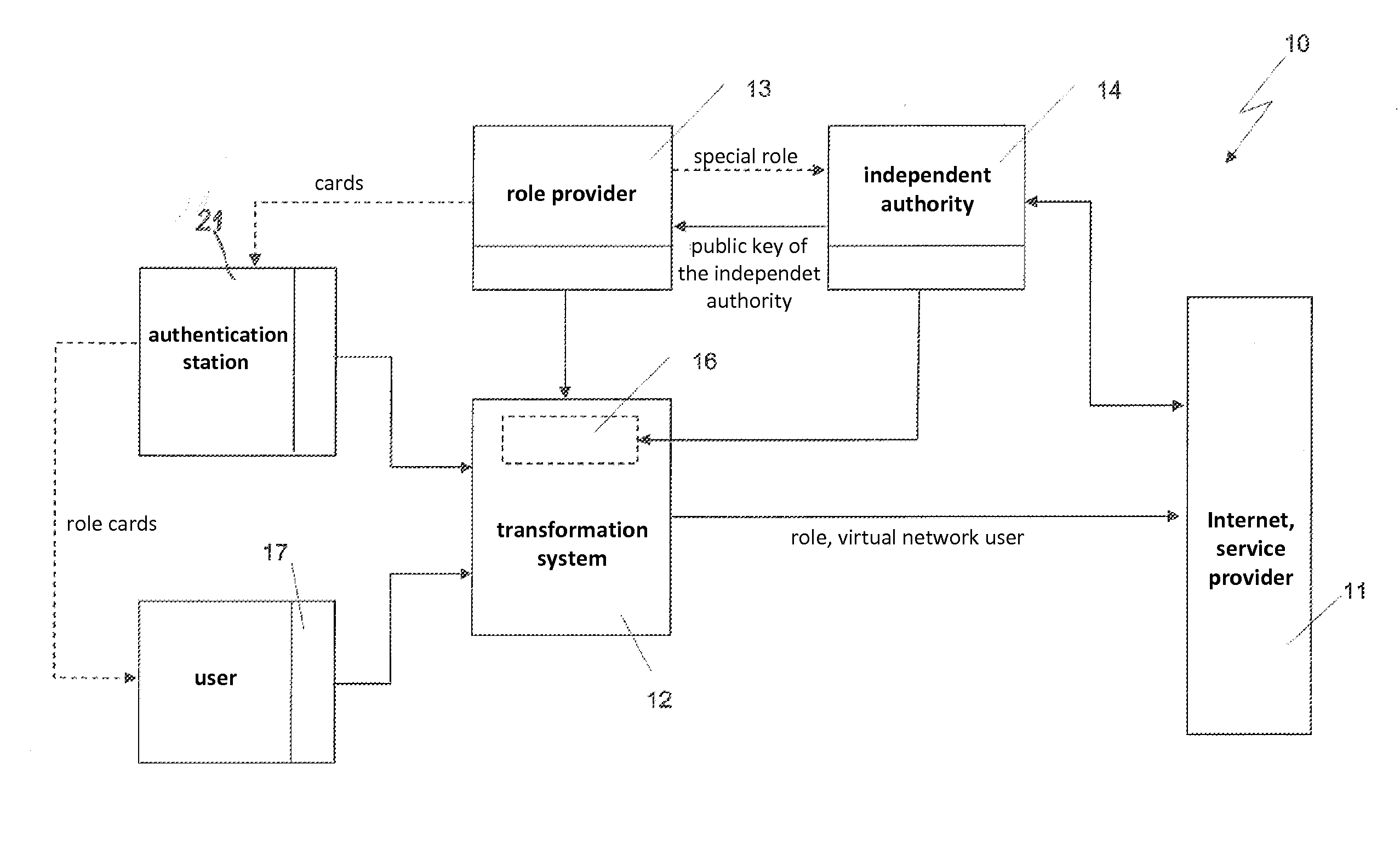

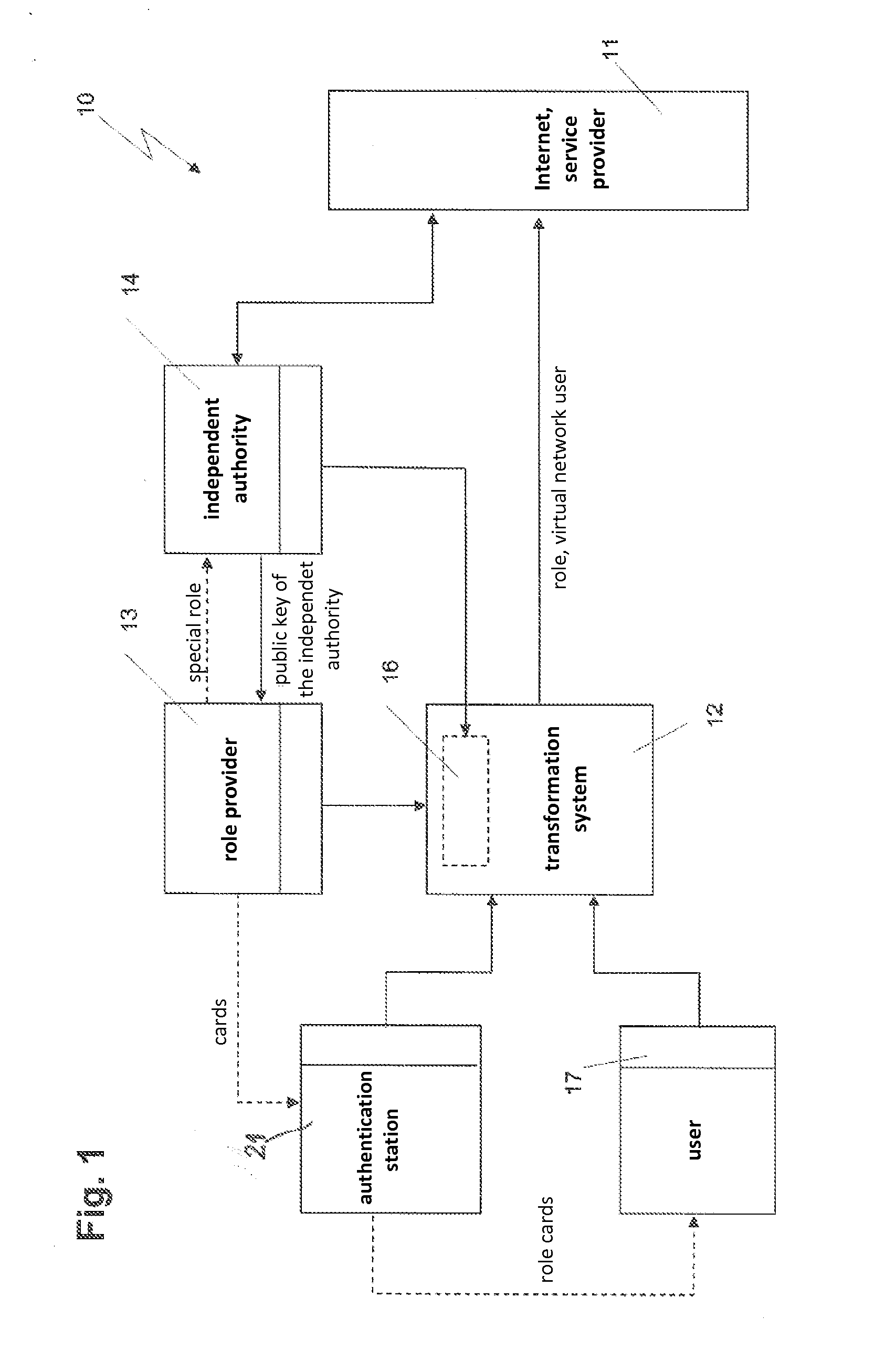

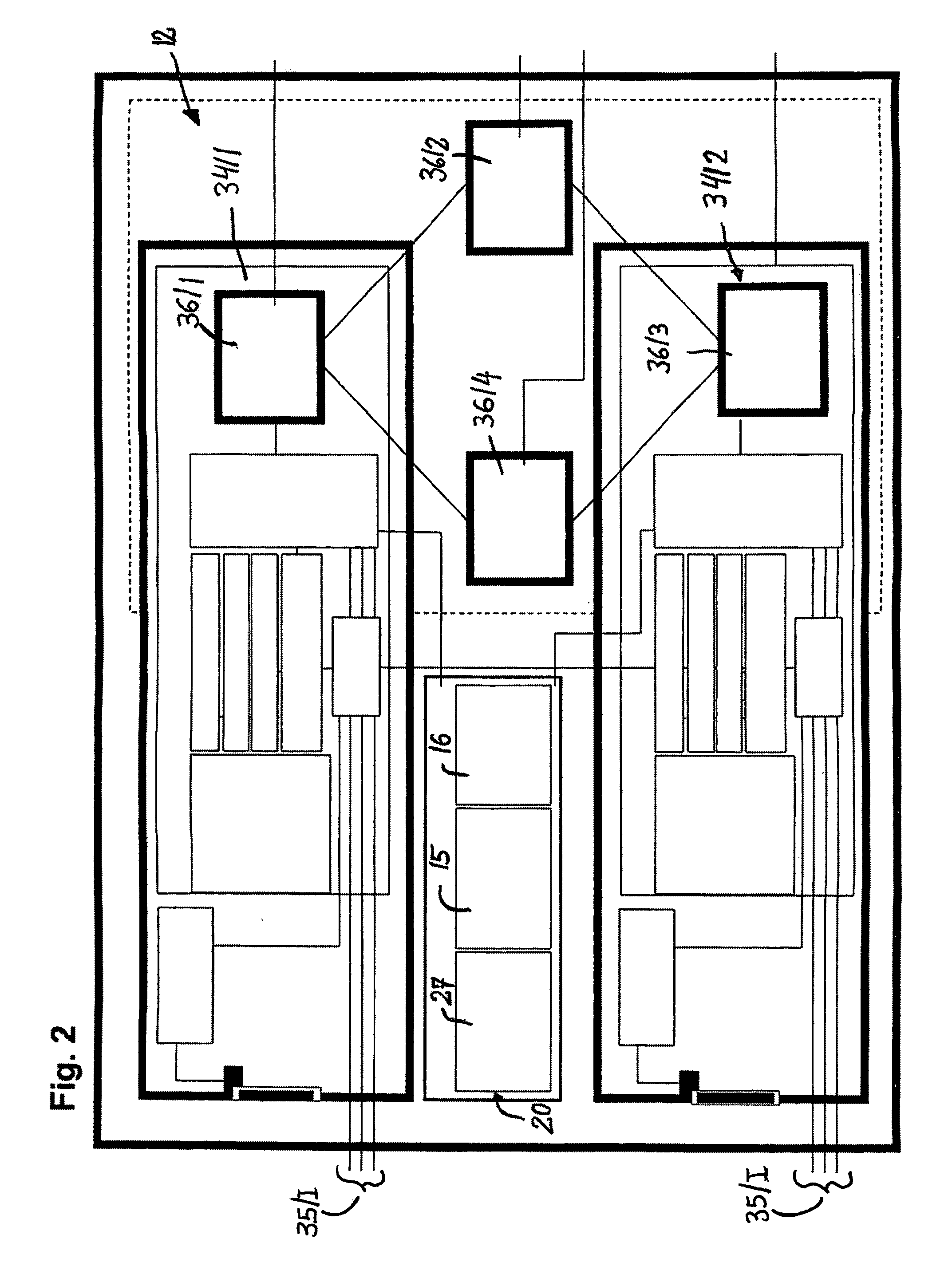

Device for generating a virtual network user

ActiveUS20110283343A1Additional safetySimple to implementDigital data processing detailsDigital data protectionTransformation systemsTime sequence

A device for generating a virtual network user that can be used, for data protection purposes, as a pseudonym by which a physical person or legal entity can gain access to the Internet and engage services that can be implemented via the network. The network user is defined by a freely specifiable combination of real and / or arbitrarily specifiable attributes. The input of these attributes into the network access device (PC) of the user activates a transformation system which facilitates the generation of the data flows that implement the virtual network user and that can be saved with the temporal sequence of the data flow in a storage device of the transformation system. An access system allocated to an independent authority is provided, which upon activation can initiate the readout of such data from a memory allocated to the storage device of the transformation system.

Owner:UNISCON UNIVERSAL IDENTITY CONTROL

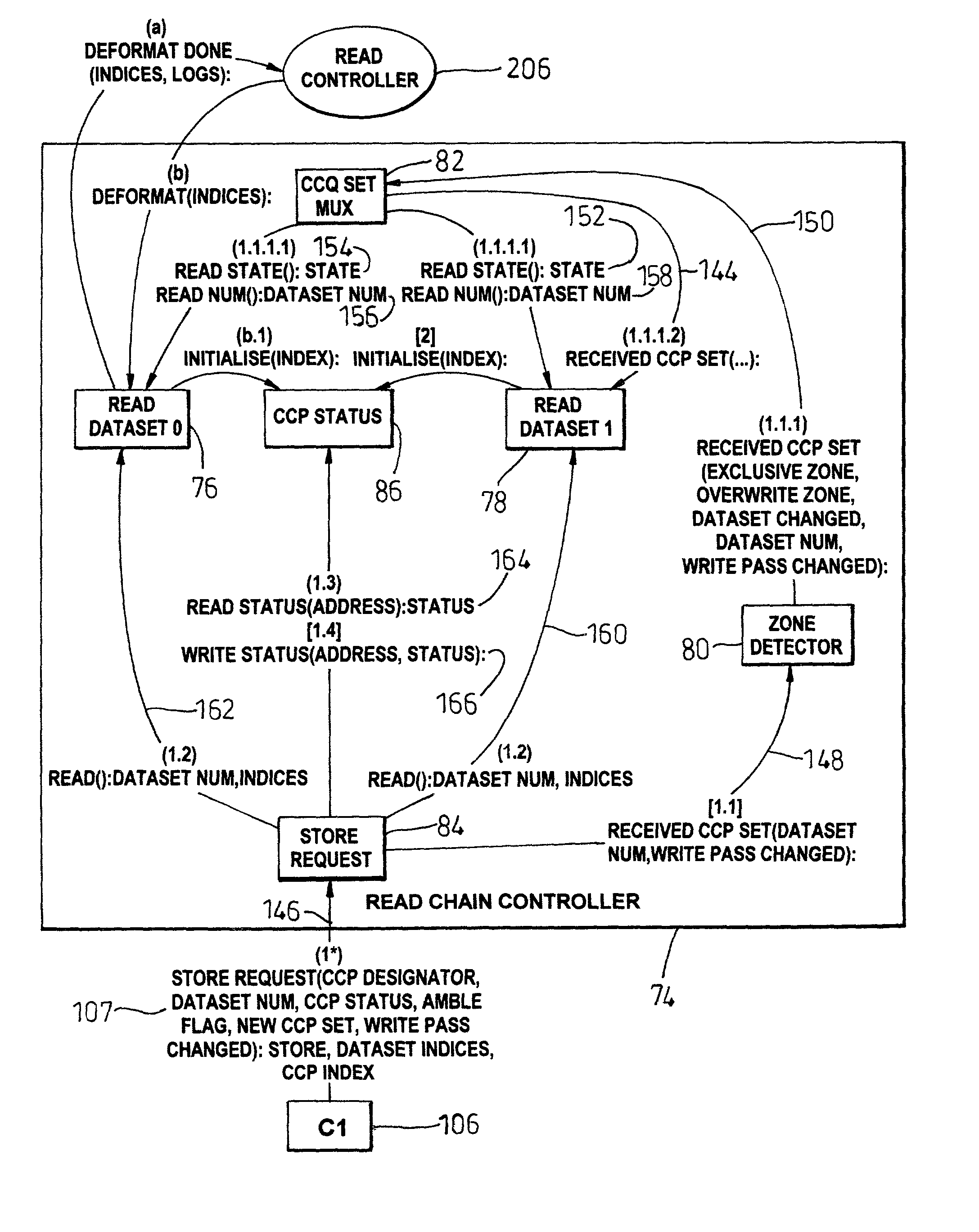

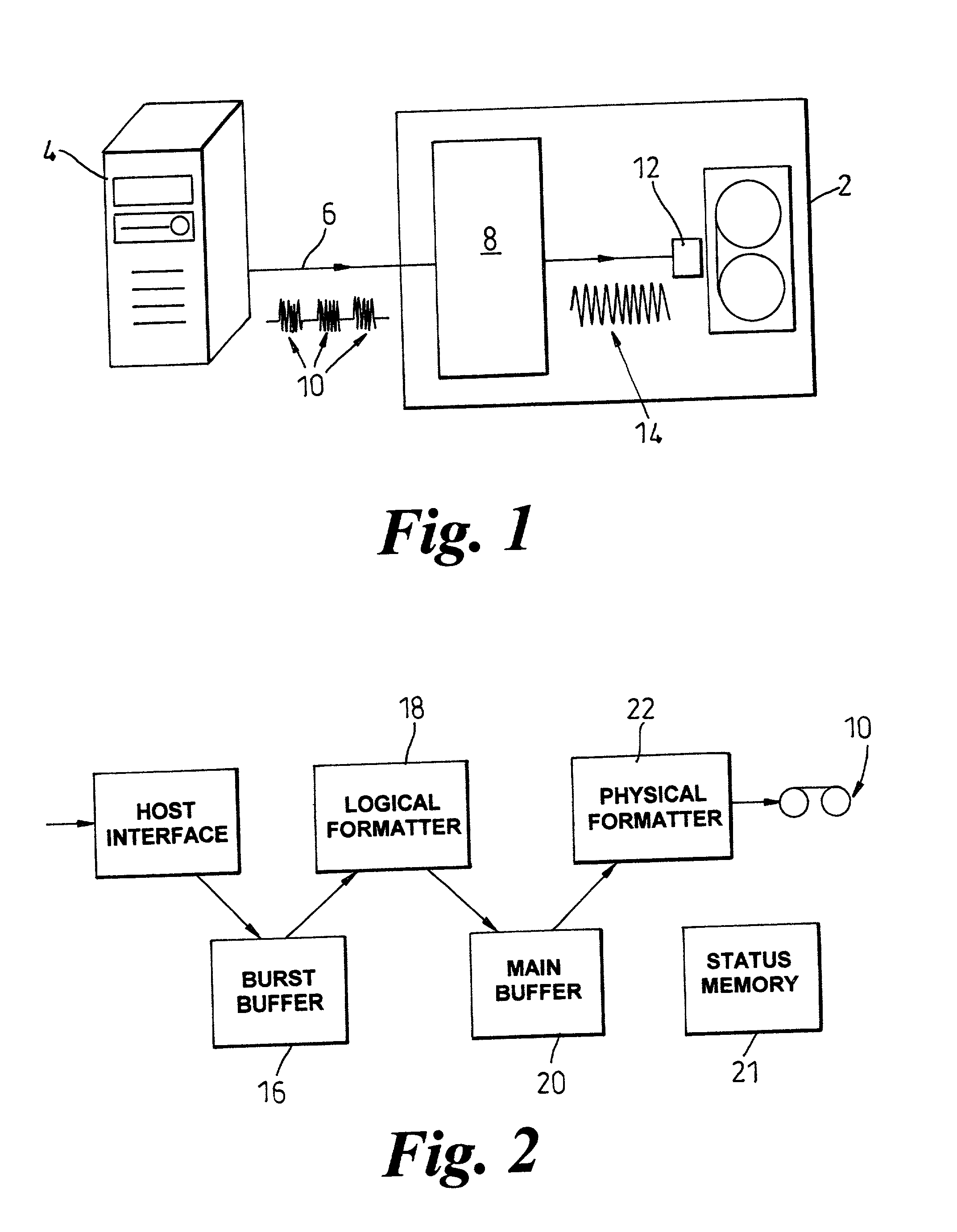

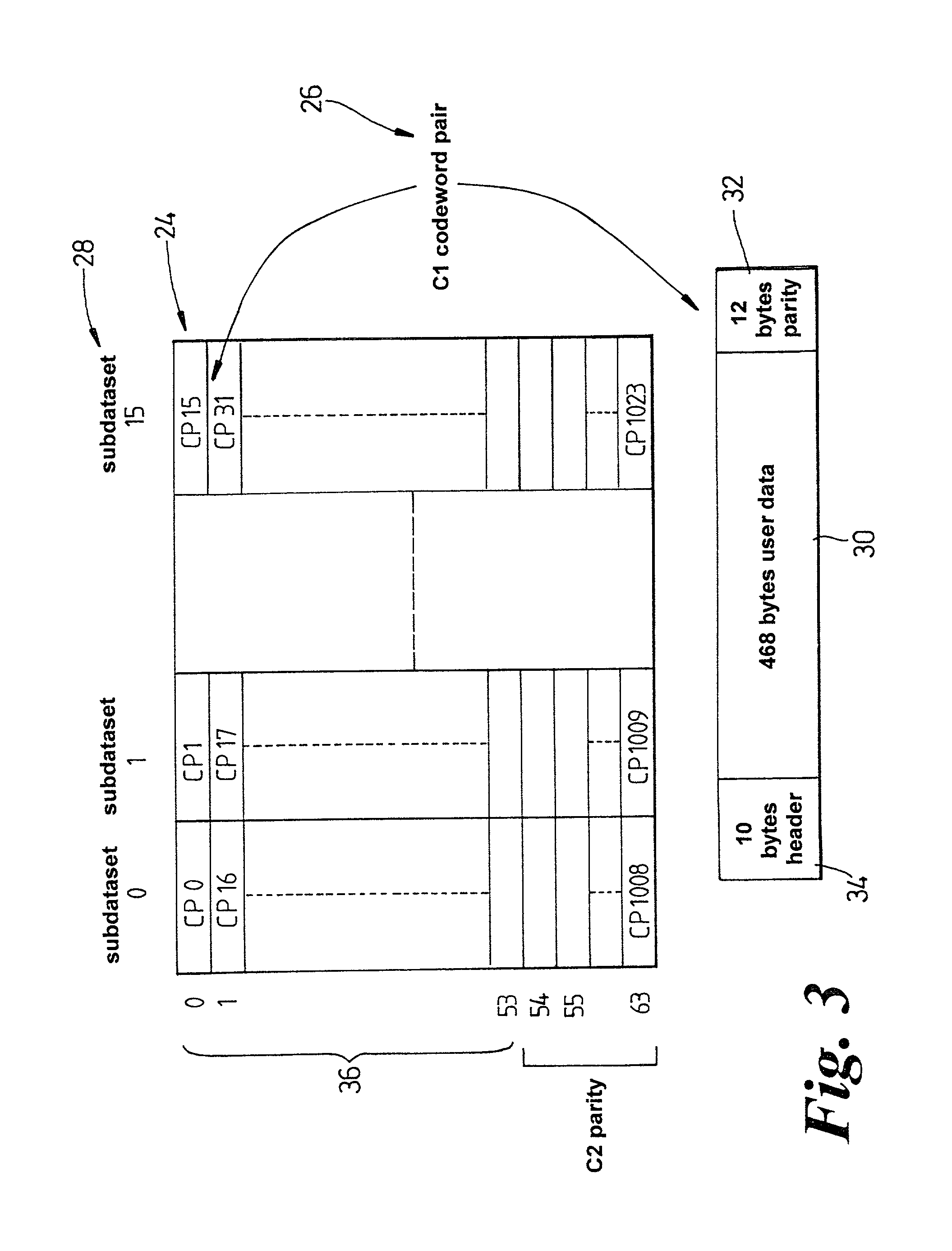

Data storage

InactiveUS20030026020A1Simple to implementEasily configureInput/output to record carriersMagneto-optical discsTape driveData signal

A data reader arranged to read a data-holding medium 10 containing both user 30 and non-user 32, 34 data, said non-user data 32, 34 holding information relating to said user data 30, said data reader comprising at least one read head 12 arranged to read the data-holding medium 10 and generate a data signal 14 comprising user data and non-user data, said user data being arranged into a plurality of sets interspersed with said non-user data, said non-user data being arranged to identify said user data within said sets, processing circuitry 8 being arranged to receive and process said data signal 14 and obtain said user data 30 from said data signal 14 using said non-user data 32, 34 to identify said user data 30 within said data signal 14. The data reader is particularly suitable for use in tape drives, and / or in situations in which re-writes, and overwrites of data occur.

Owner:HEWLETT-PACKARD ENTERPRISE DEV LP

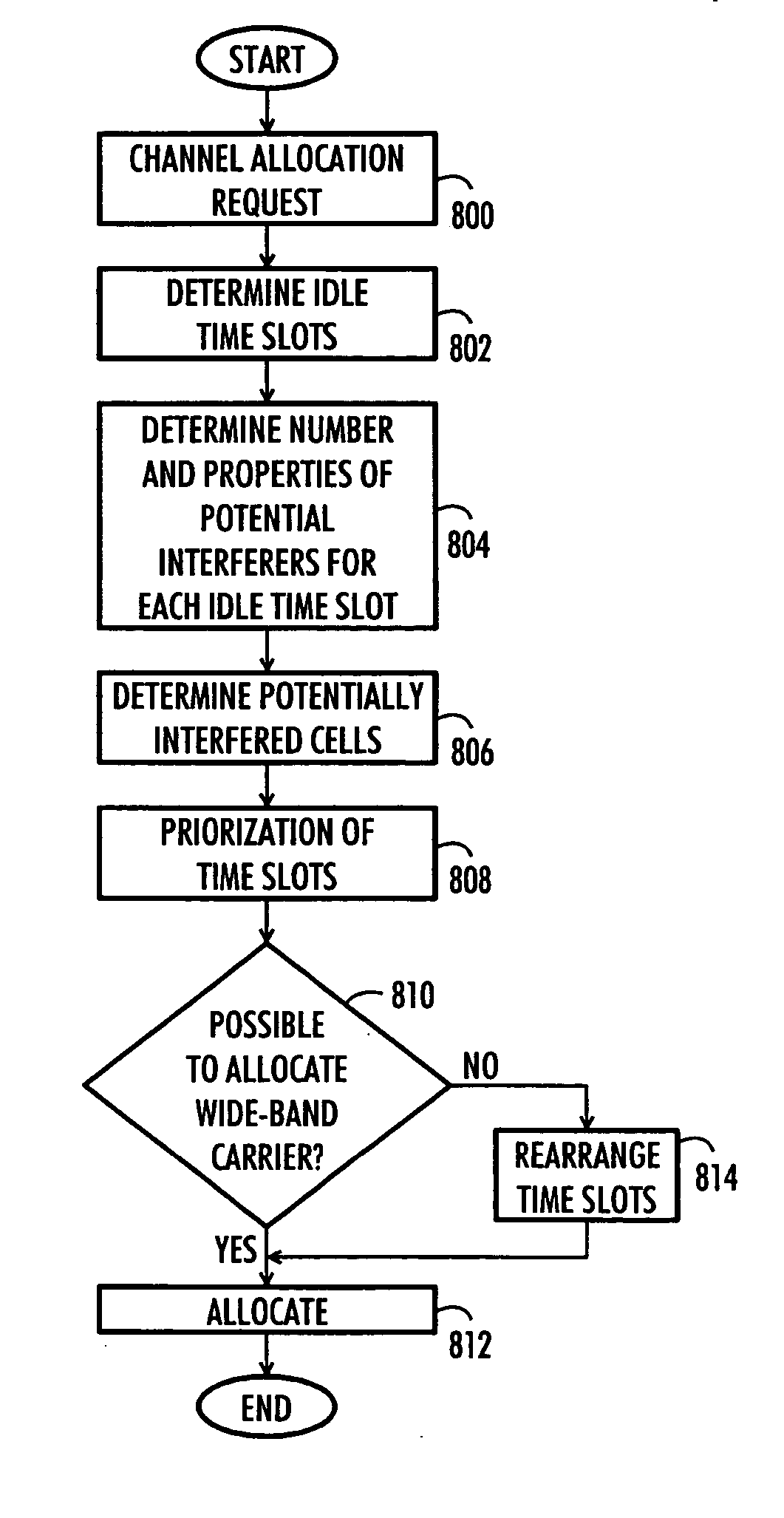

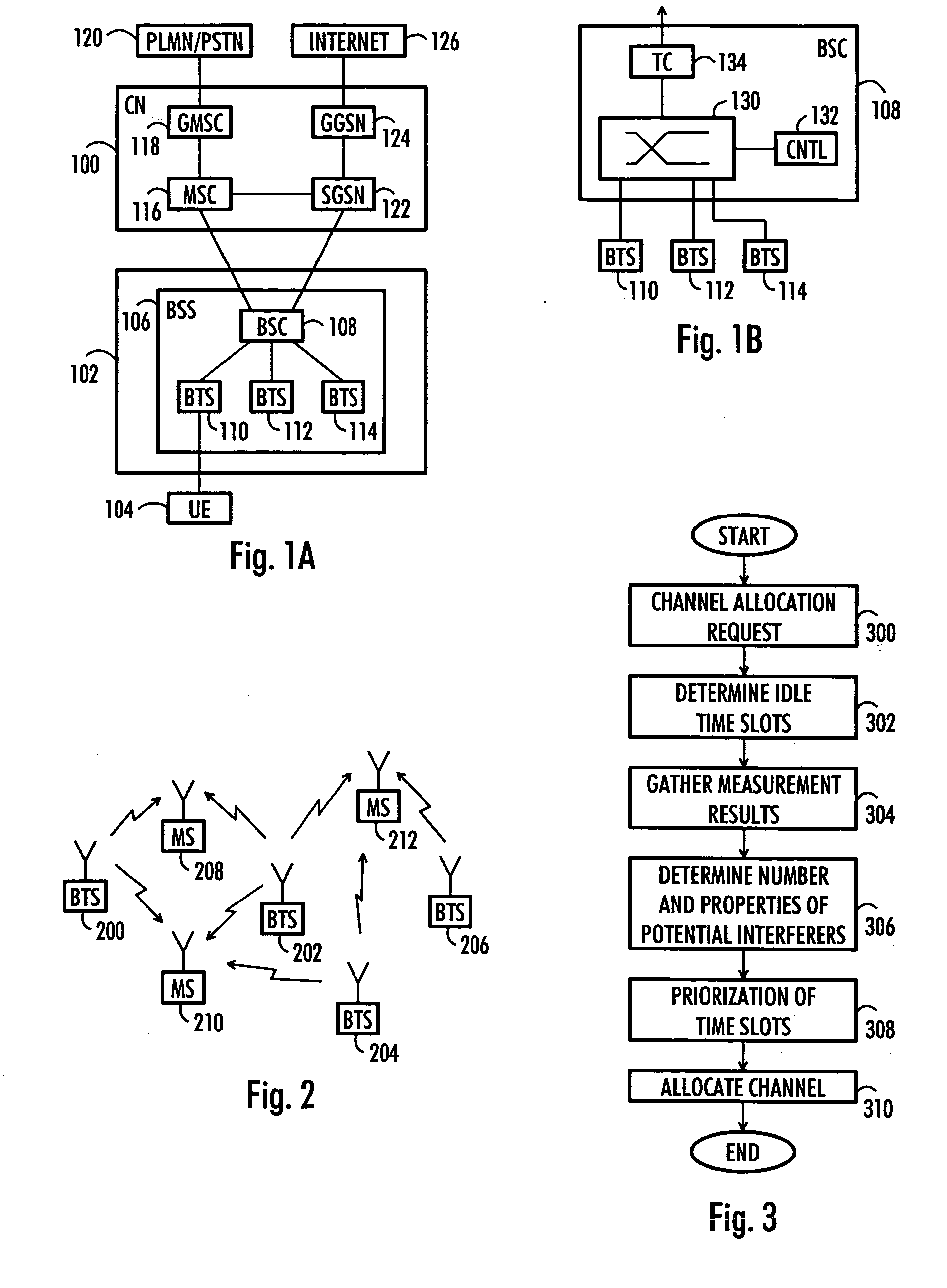

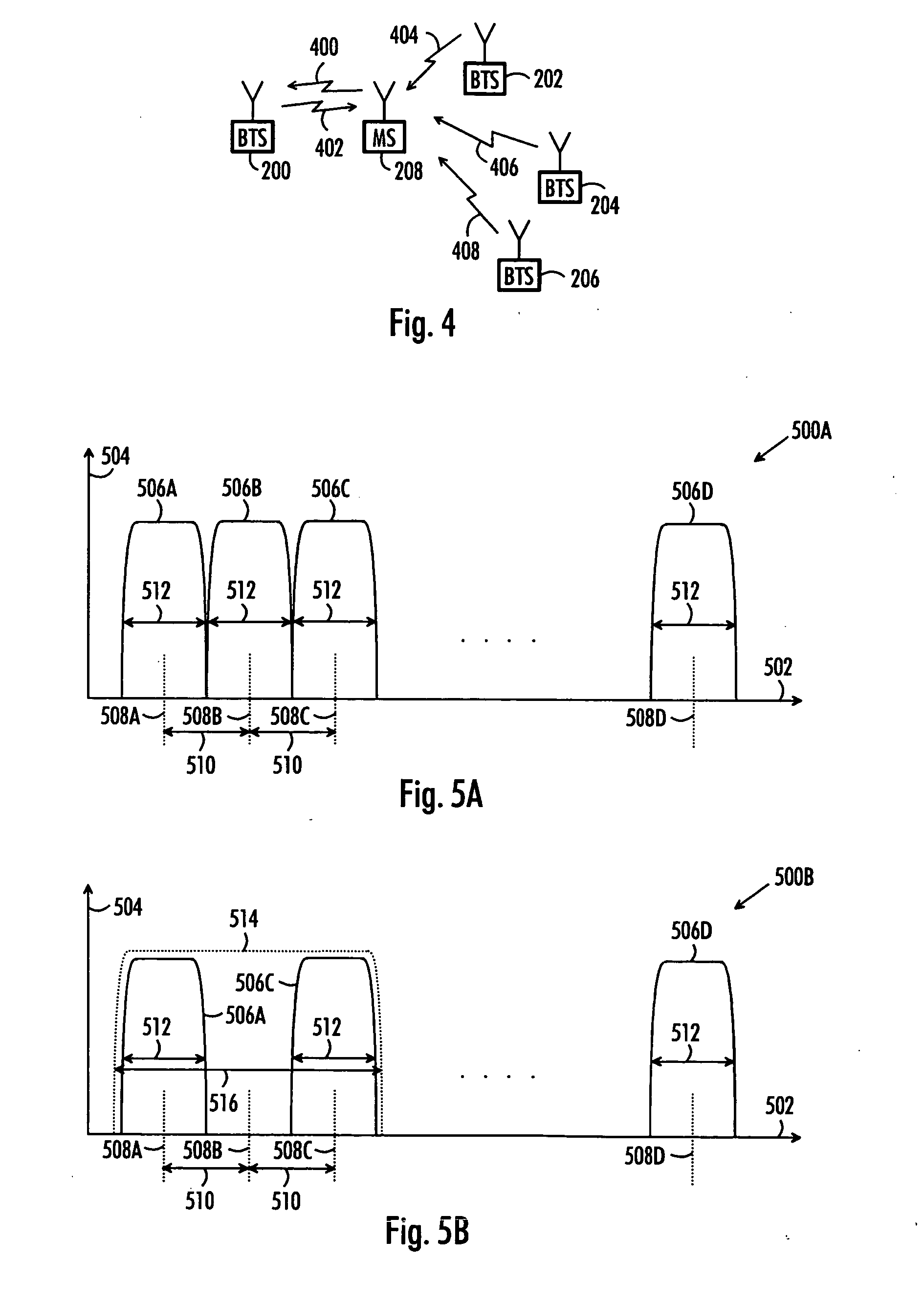

Radio channel allocation and link adaption in cellular telecommunication system

ActiveUS20070173271A1Simple to implementEnhance reception qualityNetwork traffic/resource managementRadio/inductive link selection arrangementsNetwork elementBase station

A network element, a terminal and a method of allocating a radio channel to a connection between a terminal and a base station in a telecommunication system are provided. The number and properties of potential interferers in a plurality of available radio channels are determined, and channel allocation is performed on the basis of the determination.

Owner:CORE WIRELESS LICENSING R L

Method of discriminating between an internal arc and a circuit-breaking arc in a medium or high voltage circuit breaker

InactiveUS6236548B1Simple to implementSmall investmentEmergency protective arrangements for automatic disconnectionHigh-tension/heavy-dress switchesElectric arcEngineering

The method relates to discriminating between an internal arc and a circuit-breaking arc established in the enclosure of a circuit breaker in a bay of a medium or high voltage metal-clad substation. The appearance of an internal arc is detected by a protection system which responds by transmitting a disengagement order to the circuit breaker, thereby causing a circuit-breaking arc to appear. The pressure of the dielectric gas inside the enclosure of the circuit breaker, is continuously measured and recorded so that after the instant at which the disengagement order is transmitted, it is possible to recover a first pressure value measured before the instant. The first pressure value is then compared with a second pressure value measured after the said instant in order to identify whether the internal arc was struck in the circuit breaker enclosure.

Owner:ALSTOM HLDG SA

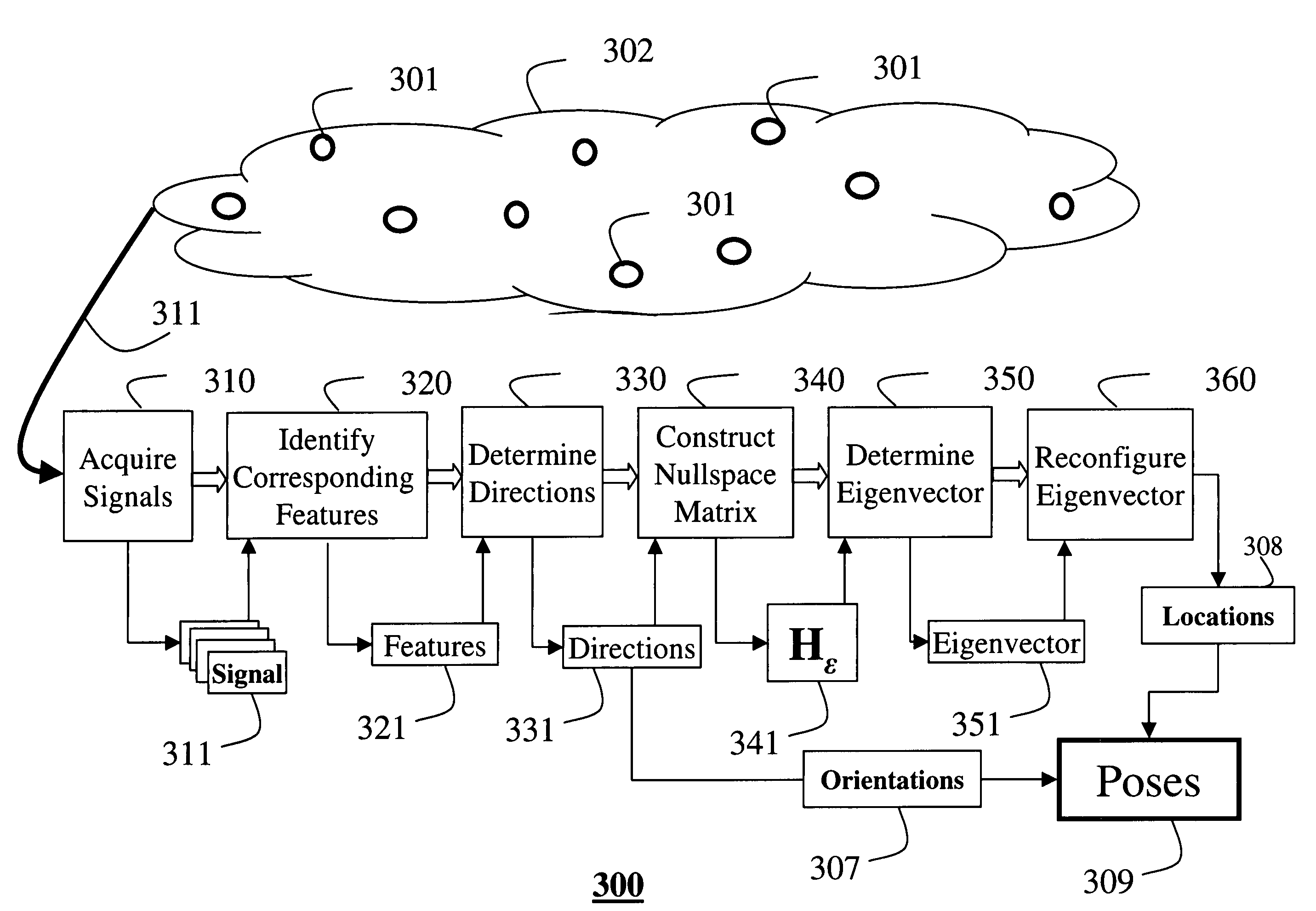

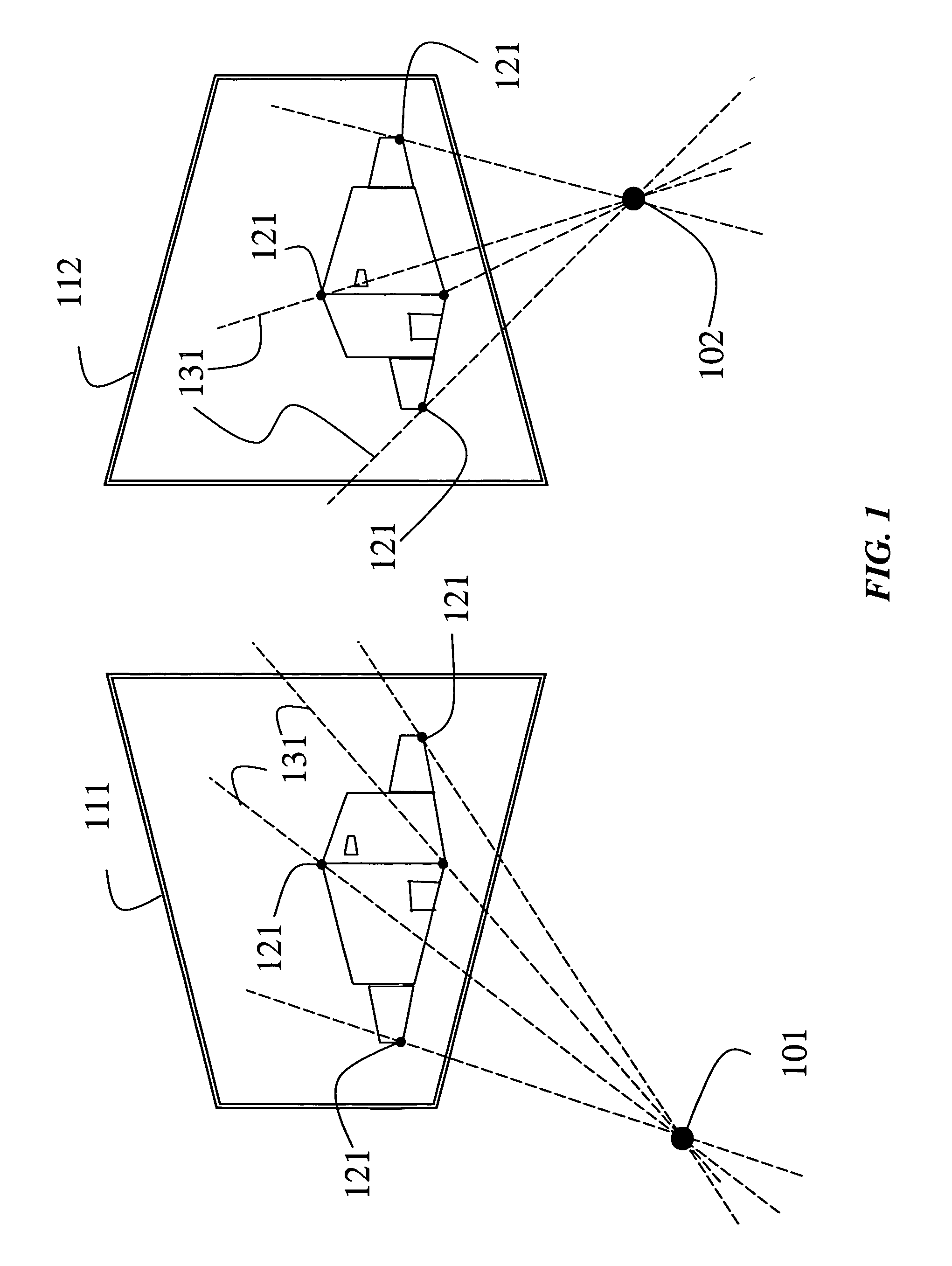

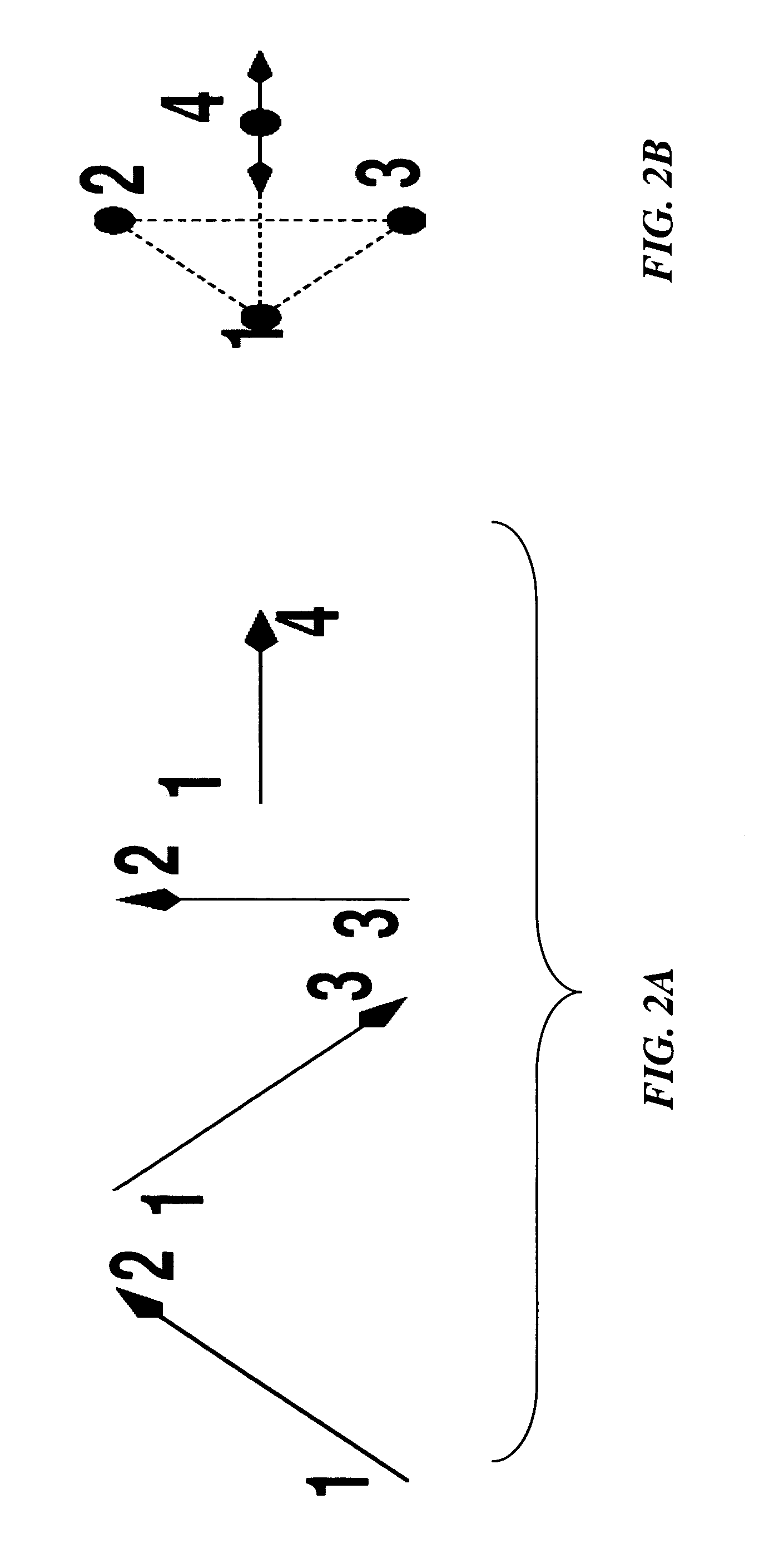

Method for determining poses of sensors

ActiveUS7006944B2Numerically stableFast to implementDirection finders using radio wavesAmplifier modifications to reduce noise influencePattern recognition

A method determines poses of a sensors distributed in an environment. A signal of the environment is acquired by each sensor. Features in each signal that correspond to the features in at least one other signal are identified. Directions between the sensors and the corresponding features are determined. Nullspaces of the directions are used to construct a matrix. A nullspace eigenvector is determined of the matrix, and then the nullspace eigenvector is reconfigured to a matrix specifying the locations of the sensors.

Owner:MITSUBISHI ELECTRIC RES LAB INC

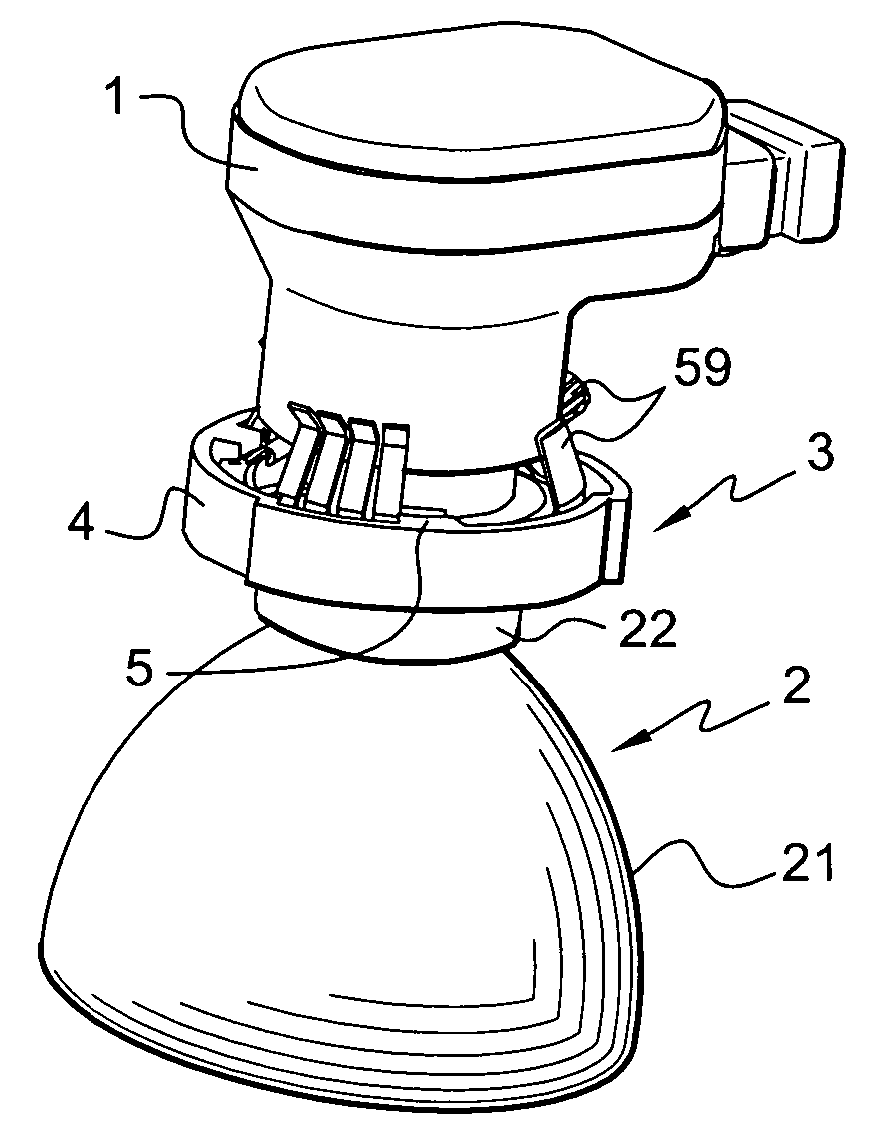

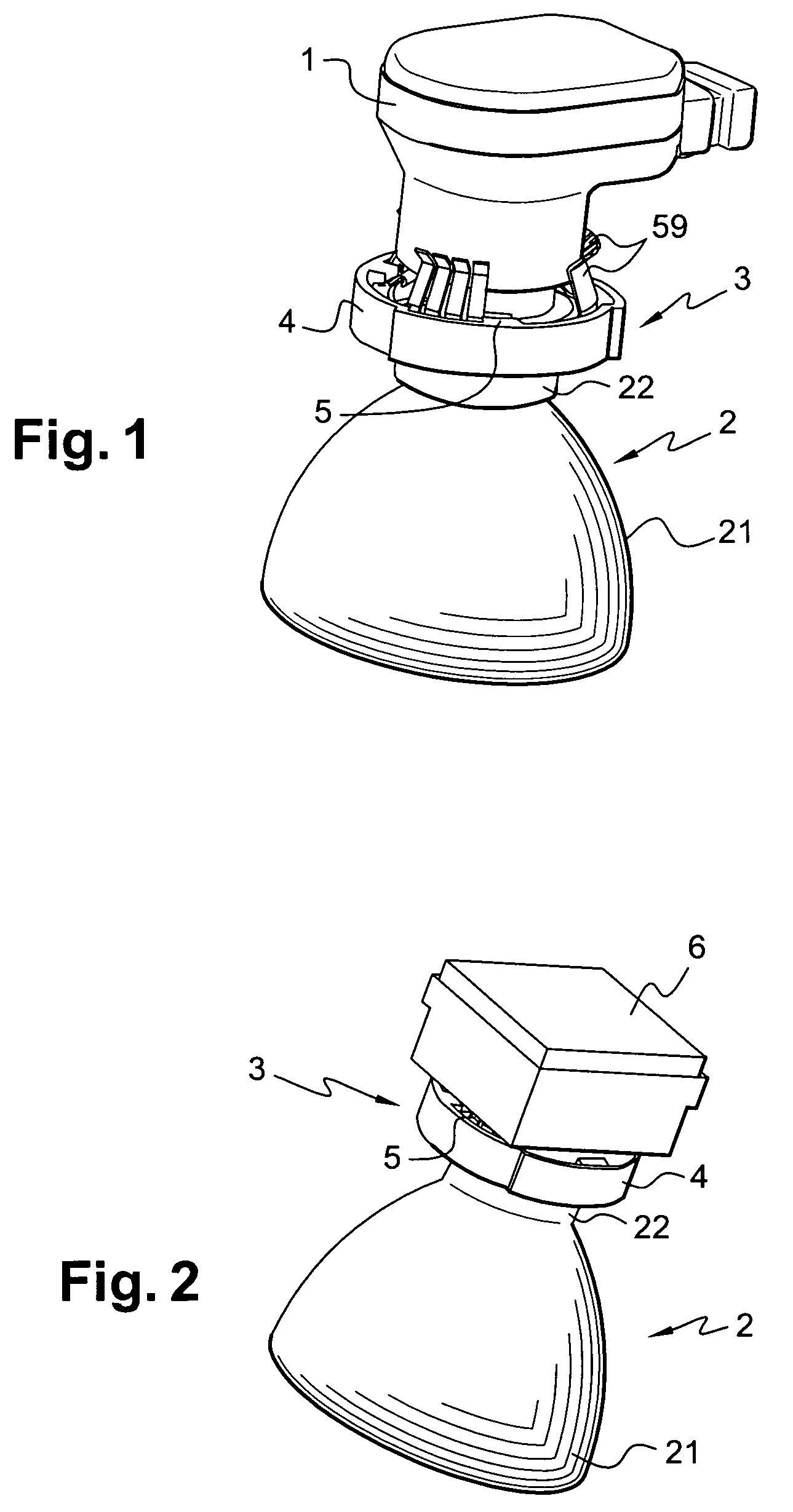

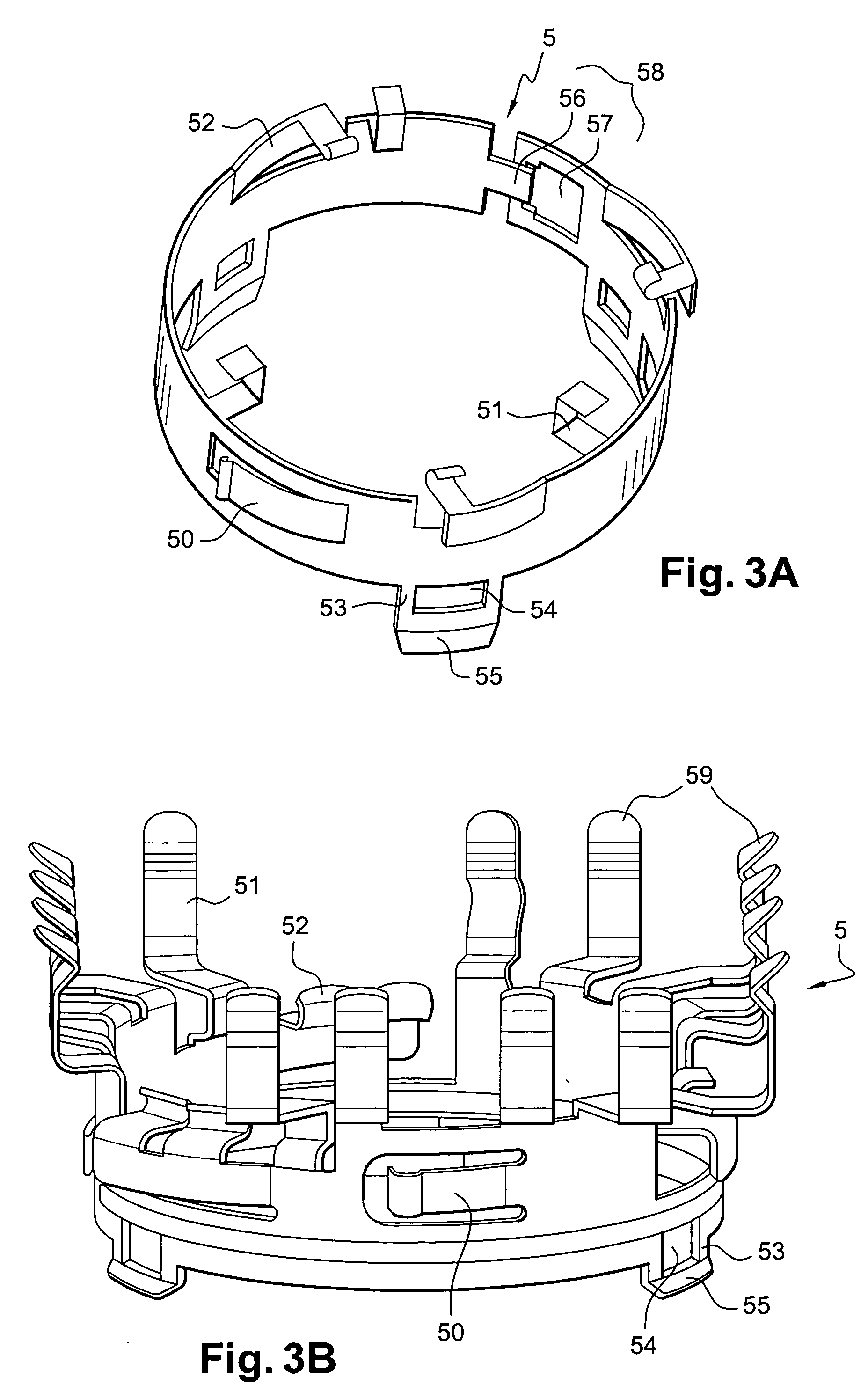

System for fixing a lamp to a headlight lamp holder for an automobile

InactiveUS20060152940A1Simple to implementEasy to implementPoint-like light sourcePortable electric lightingEngineeringXenon lamp

A lighting and / or signaling device for an automobile comprising a xenon lamp and a mating part comprising a reflector and a lamp holder providing the holding of a bulb of the discharge lamp in front of the reflector. A system for fixing the xenon lamp on the mating part comprising a rigid ring able to be mounted, so as to be able to move in rotation, about the lamp holder and a flexible annulus mounted inside the rigid ring and fixed to the lamp holder so as to be non-removable.

Owner:VALEO VISION SA

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com