Patents

Literature

270results about How to "Increase likelihood" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Method for presenting advertising in an interactive service

InactiveUS7072849B1Minimizes potential for interferenceRaise the possibilityAdvertisementsSpecial data processing applicationsPersonalizationGraphics

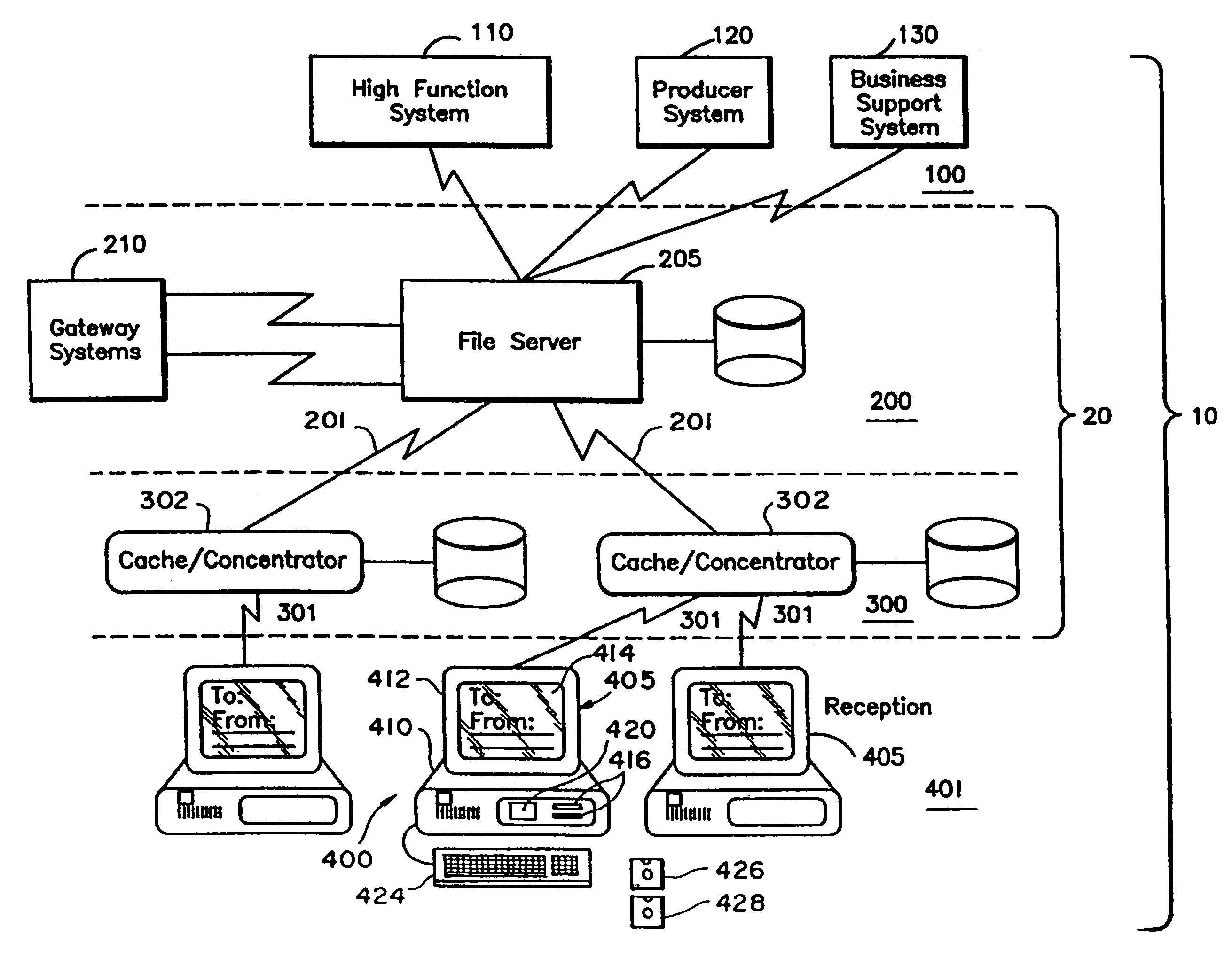

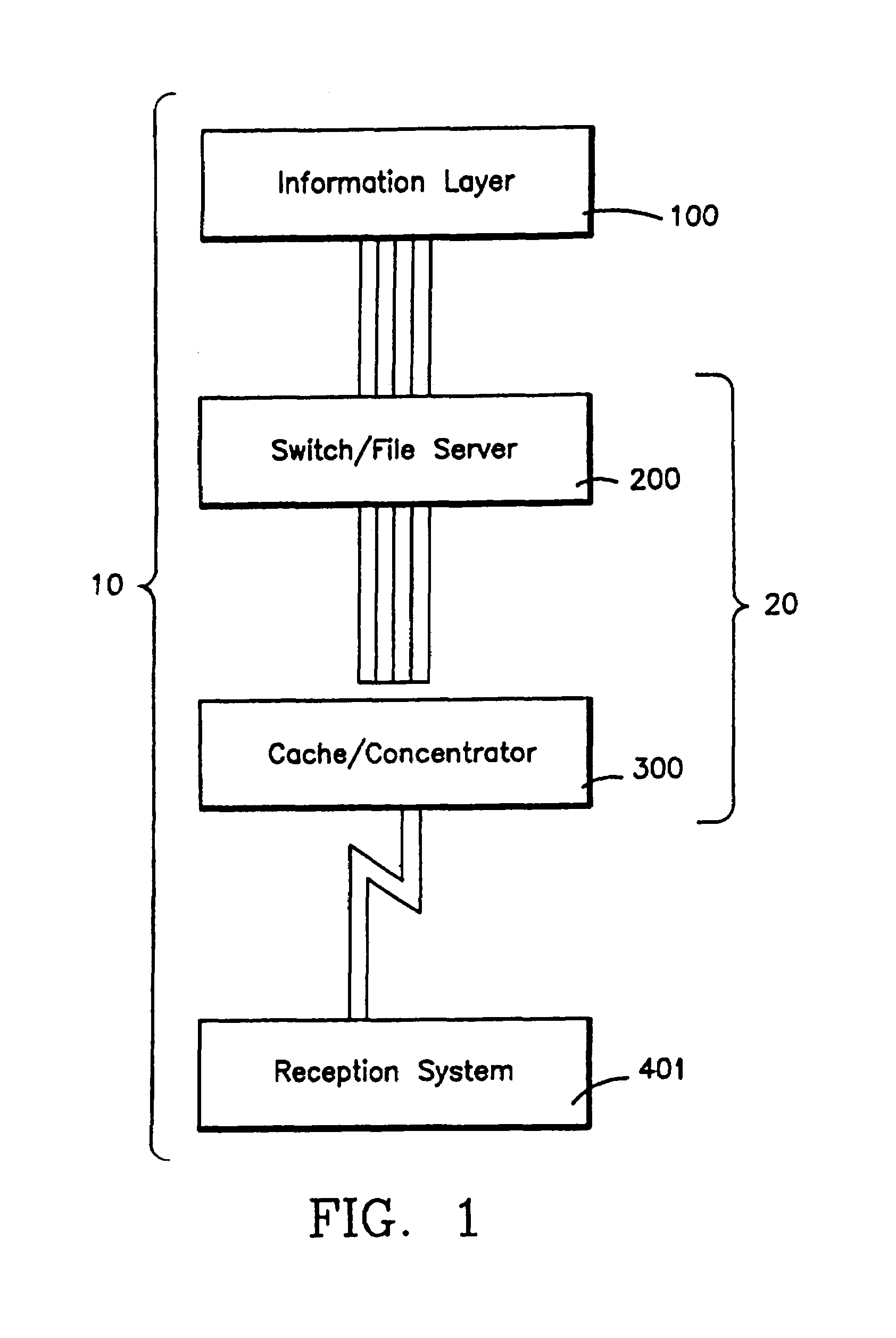

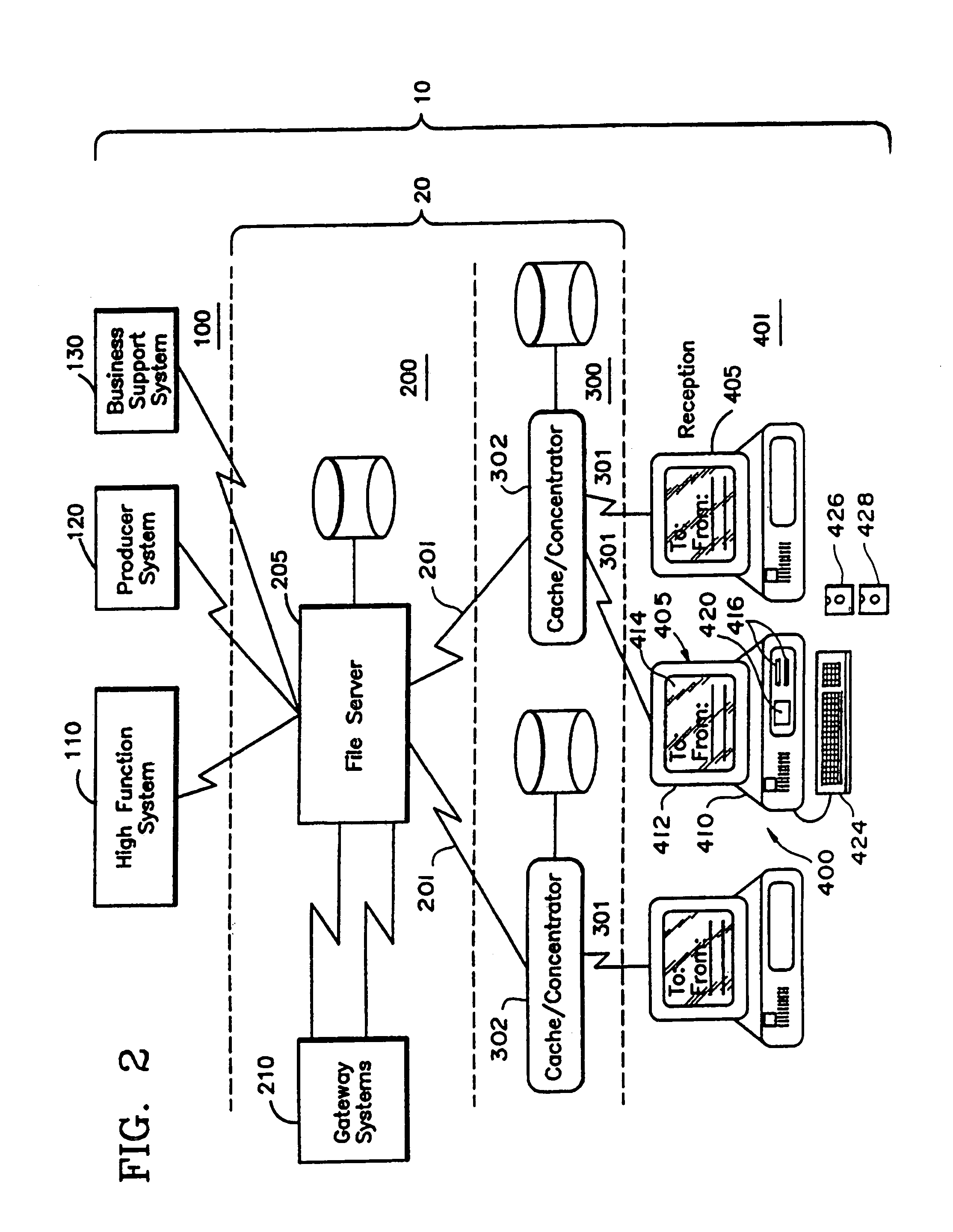

A method for presenting advertising in an interactive service provided on a computer network, the service featuring applications which include pre-created, interactive text / graphic sessions is described. The method features steps for presenting advertising concurrently with service applications at the user terminal configured as a reception system. In accordance with the method, the advertising is structured in a manner comparable to the service applications enabling the applications to be presented at a first portion of a display associated with the reception system and the advertising presented at a second portion. Further, steps are provided for storing and managing advertising at the user reception system so that advertising can be pre-fetched from the network and staged in anticipation of being called for presentation. This minimizes the potential for communication line interference between application and advertising traffic and makes the advertising available at the reception system so as not to delay presentation of the service applications. Yet further the method features steps for individualizing the advertising supplied to enhance potential user interest by providing advertising based on a characterization of the user as defined by the users interaction with the service, user demographics and geographical location. Yet additionally, advertising is provided with transactional facilities so that users can interact with it.

Owner:INT BUSINESS MASCH CORP

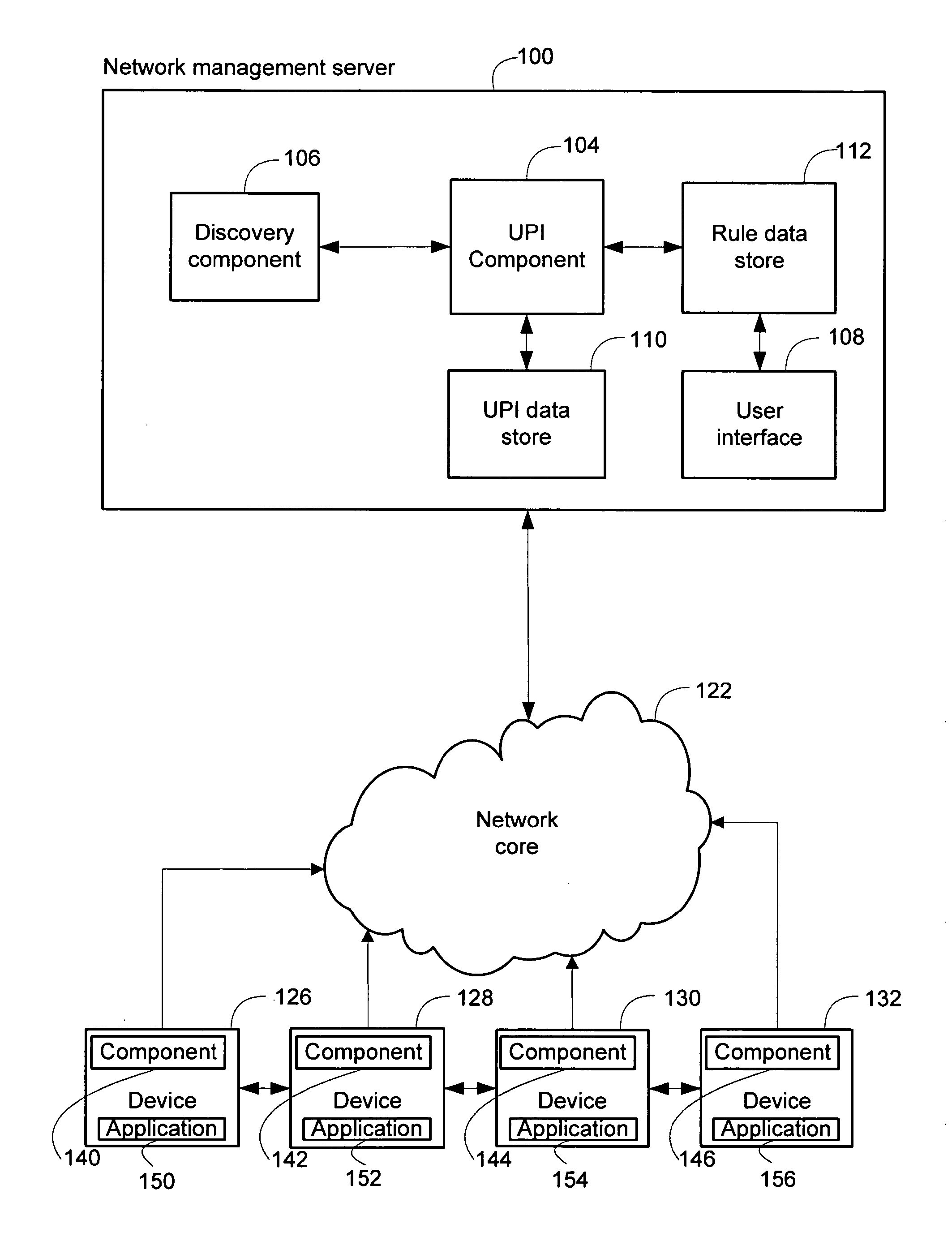

System and method for generating unique and persistent identifiers

InactiveUS20080010366A1Increase likelihoodRaise the possibilityDigital computer detailsTransmissionEntity typeRule sets

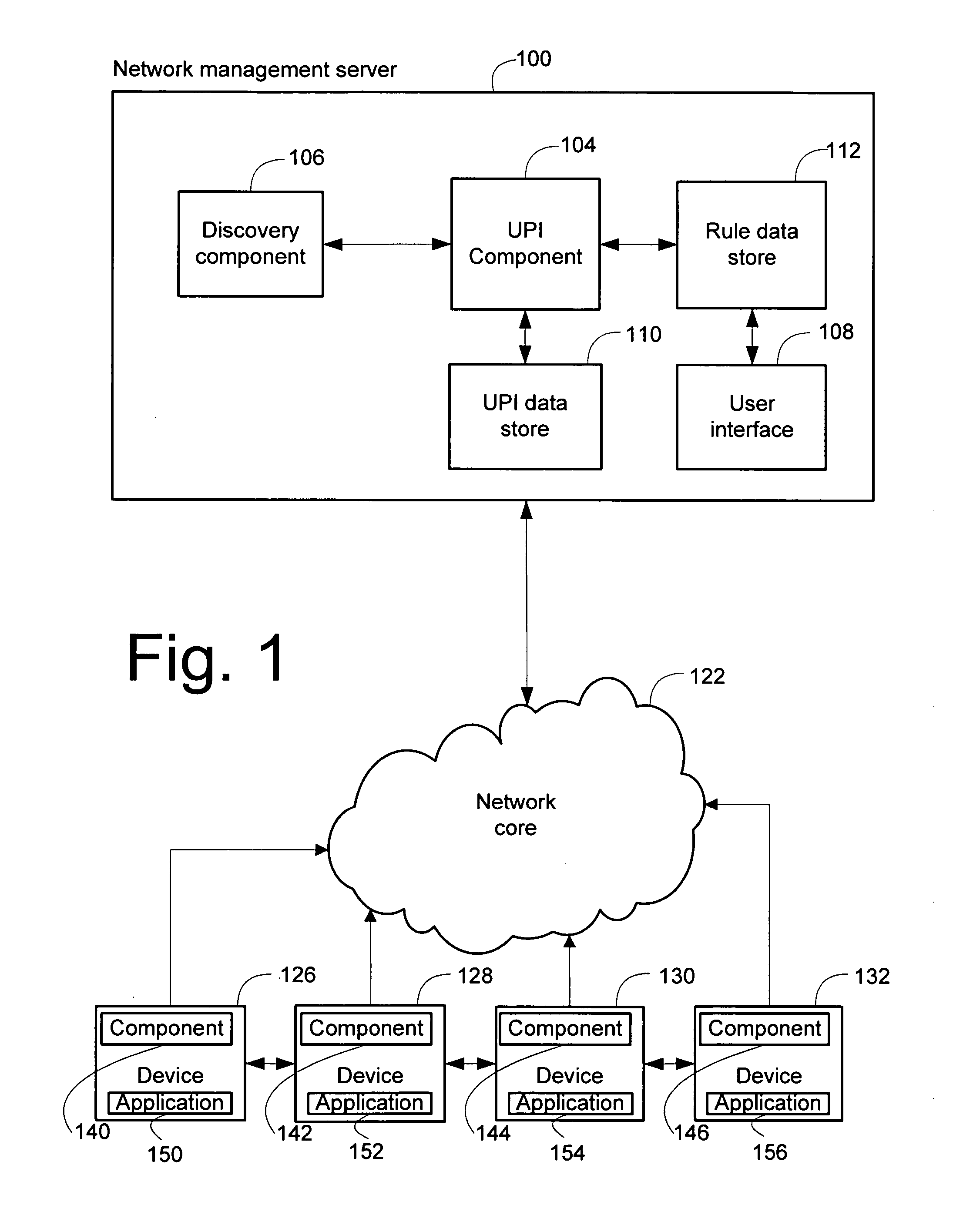

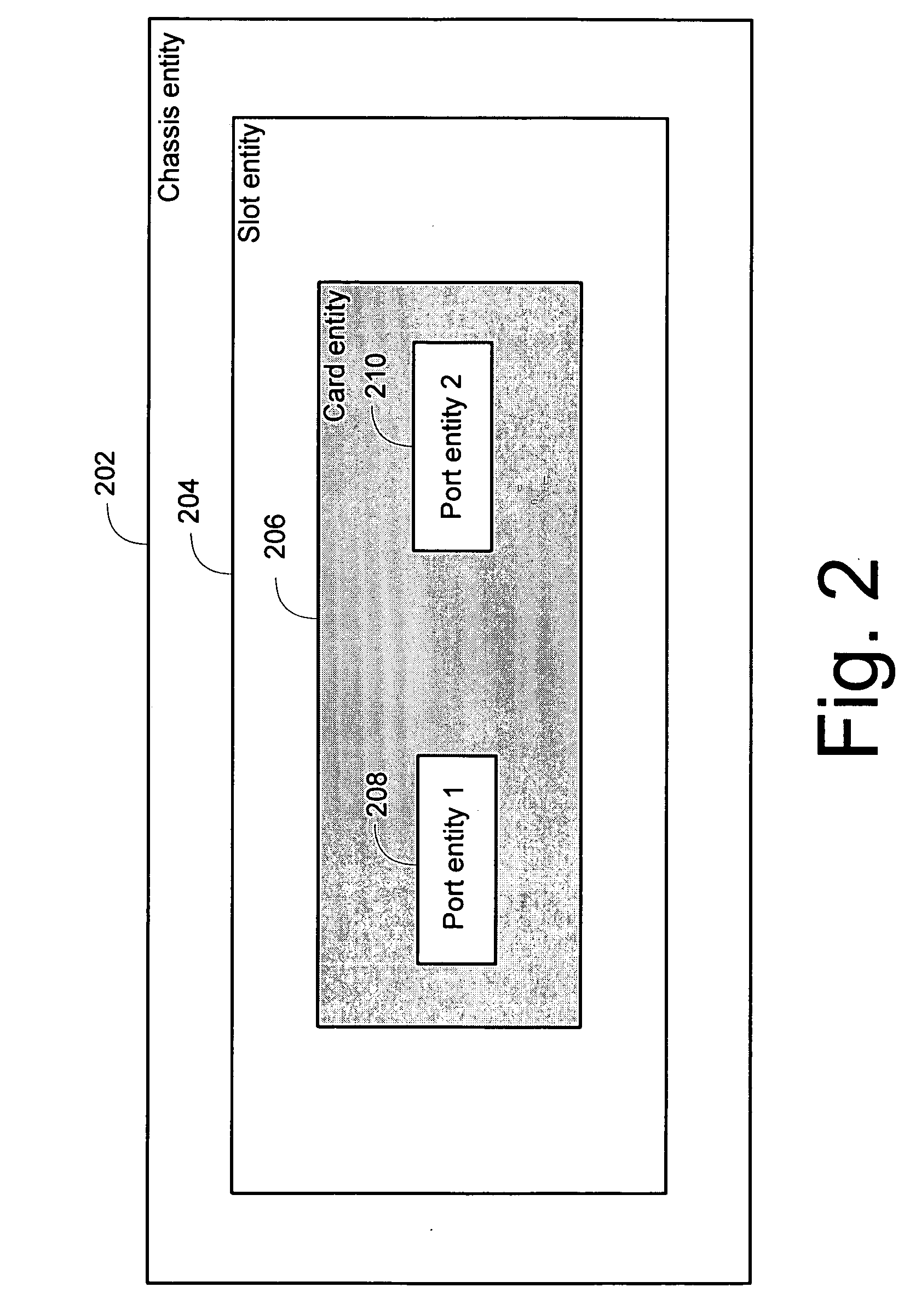

The present invention relates to systems and methods for generating unique and persistent identifiers for one or more entities within a network. The method of the present invention comprises discovering one or more entities within a network, a given entity associated with one or more attributes and an entity type. One or more unique and persistent identifier generation rule sets comprising one or more unique and persistent identifier generation rules are retrieved, wherein the rule sets correspond to the one or more entity types discovered within the network. Unique and persistent identifiers are generated for the one or more discovered entities within the network through use of the unique and persistent identifier generation rule sets and the one or more attributes associated with the one or more entities.

Owner:IBM CORP

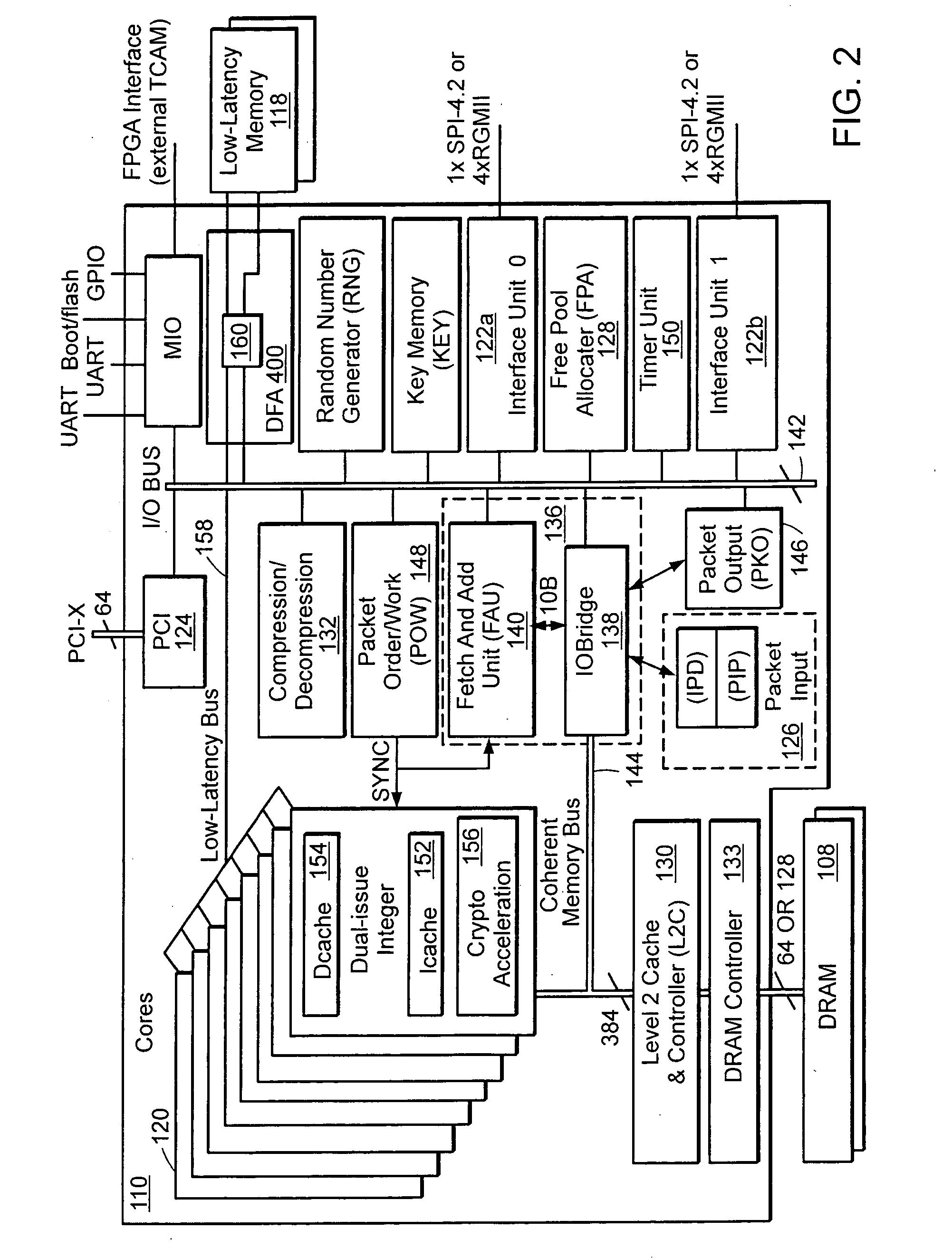

Selective replication of data structures

ActiveUS20070038798A1Increase likelihoodReduce possibilityMemory architecture accessing/allocationDigital data processing detailsThermometerMemory bank

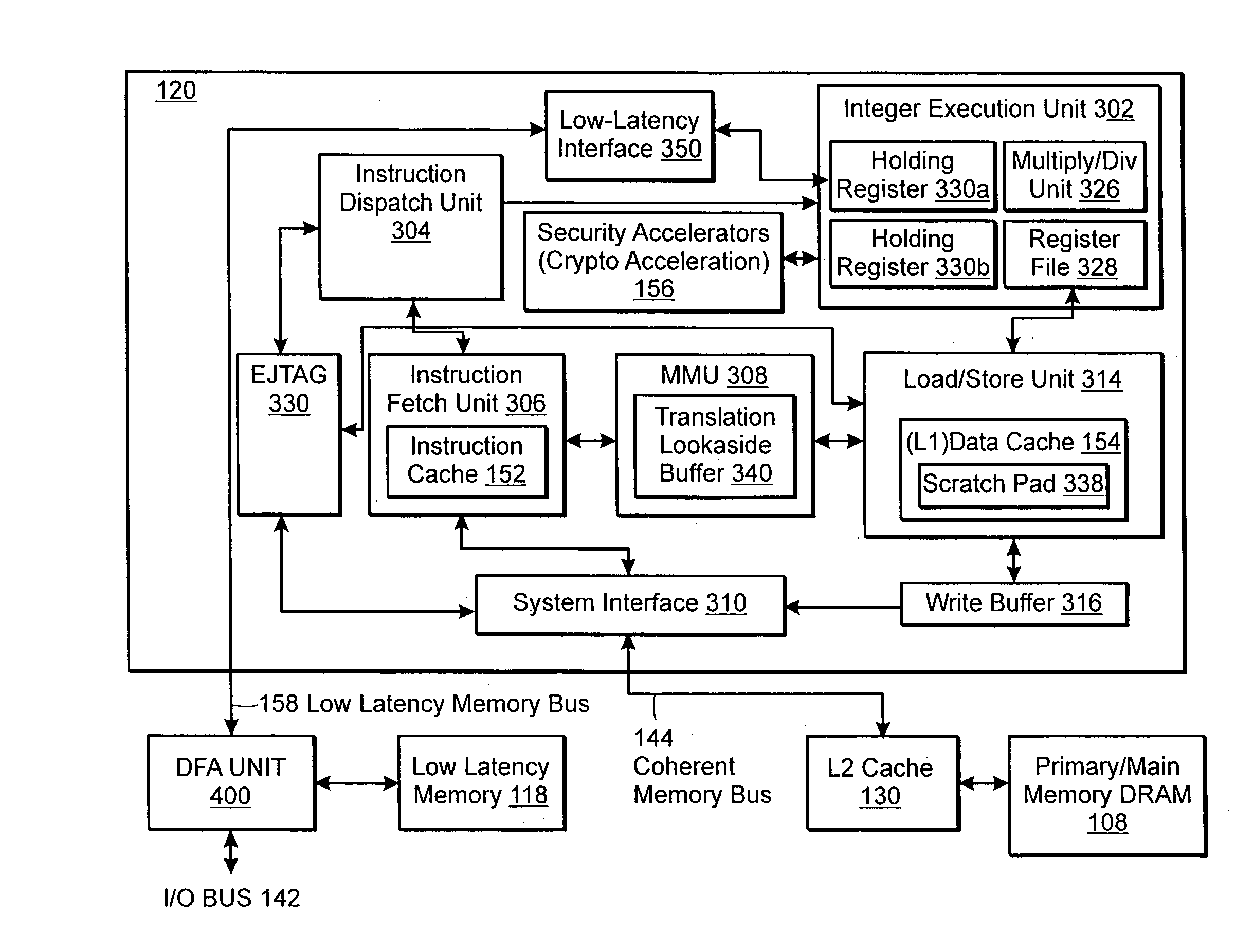

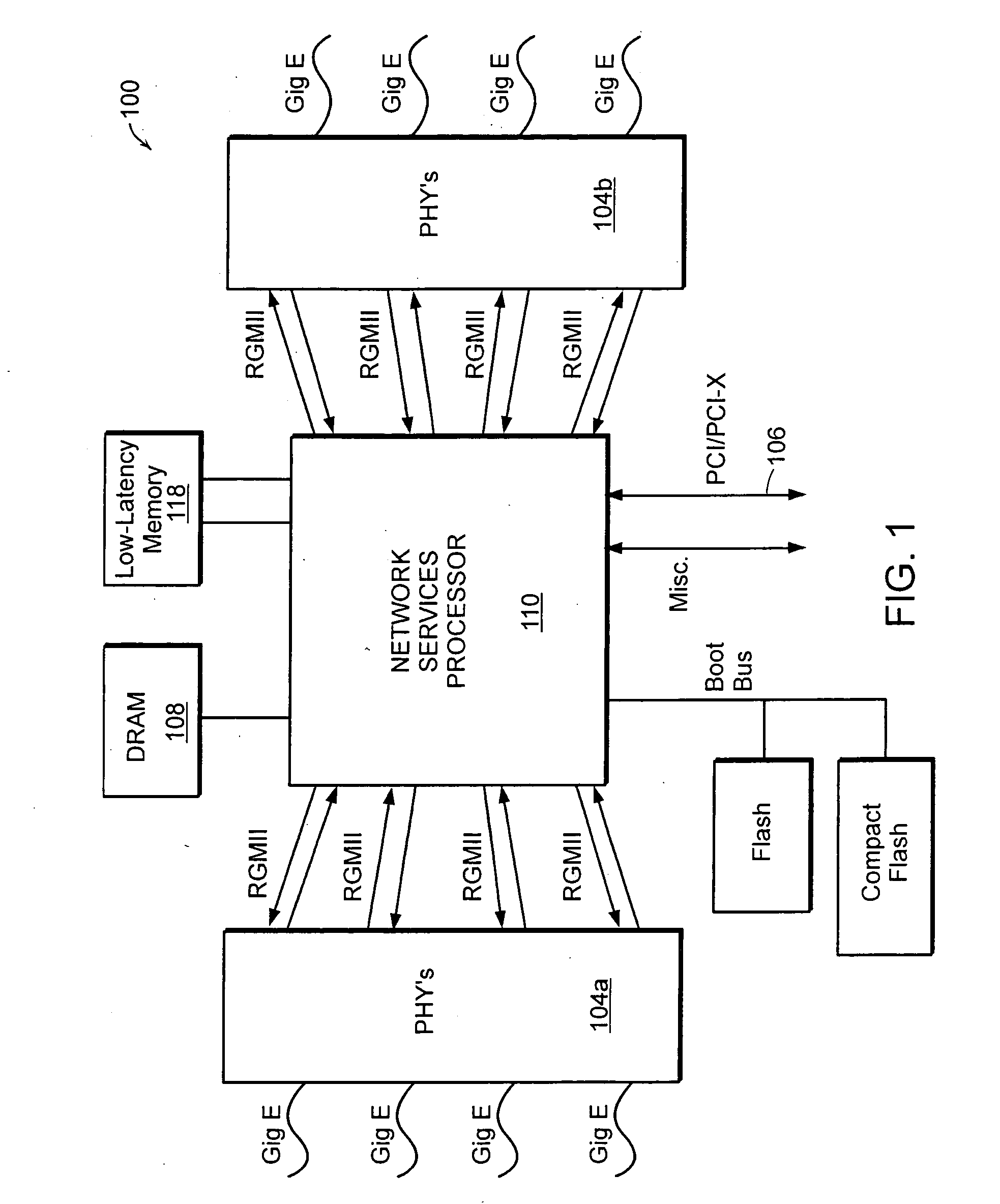

Methods and apparatus are provided for selectively replicating a data structure in a low-latency memory. The memory includes multiple individual memory banks configured to store replicated copies of the same data structure. Upon receiving a request to access the stored data structure, a low-latency memory access controller selects one of the memory banks, then accesses the stored data from the selected memory bank. Selection of a memory bank can be accomplished using a thermometer technique comparing the relative availability of the different memory banks. Exemplary data structures that benefit from the resulting efficiencies include deterministic finite automata (DFA) graphs and other data structures that are loaded (i.e., read) more often than they are stored (i.e., written).

Owner:MARVELL ASIA PTE LTD

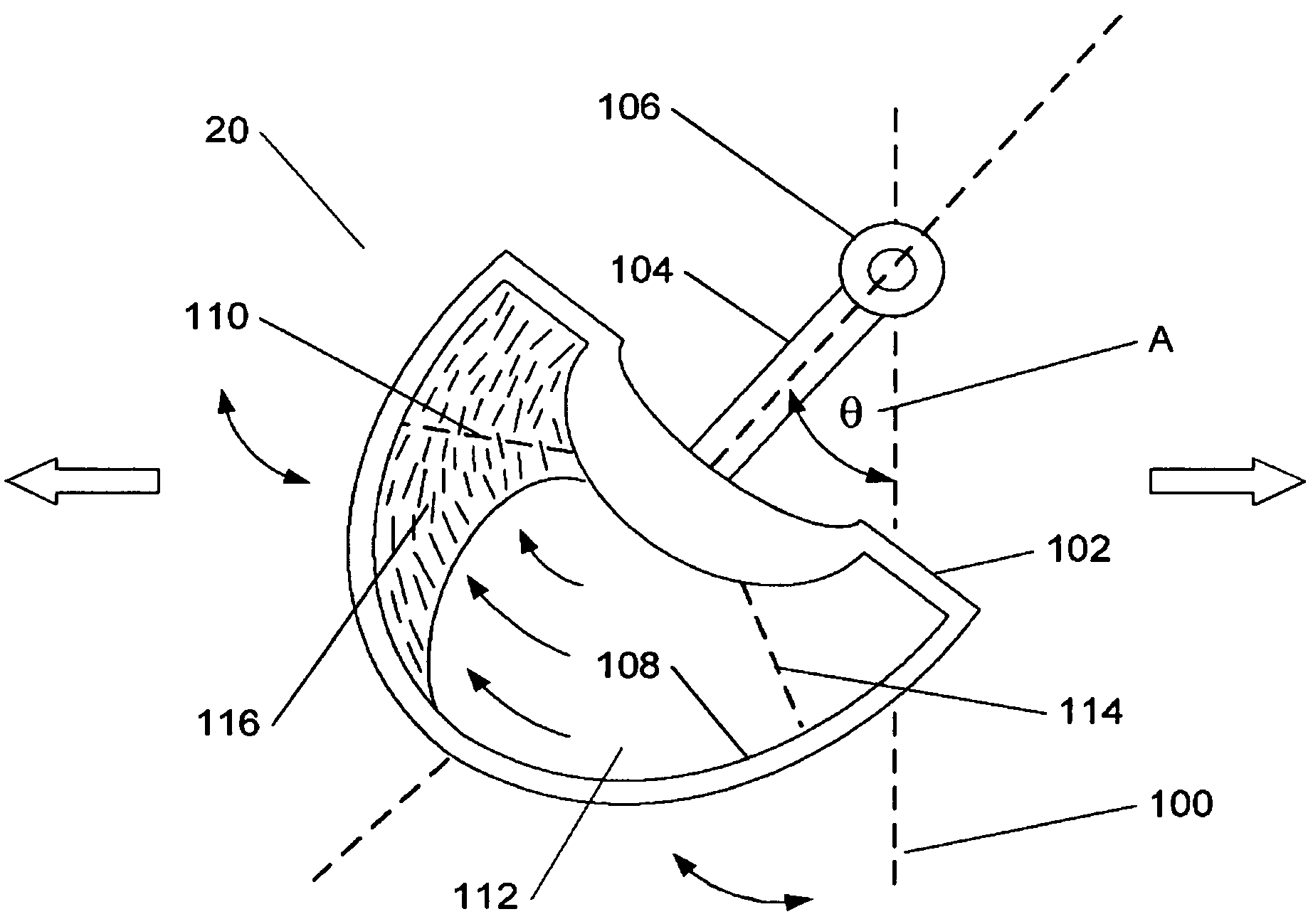

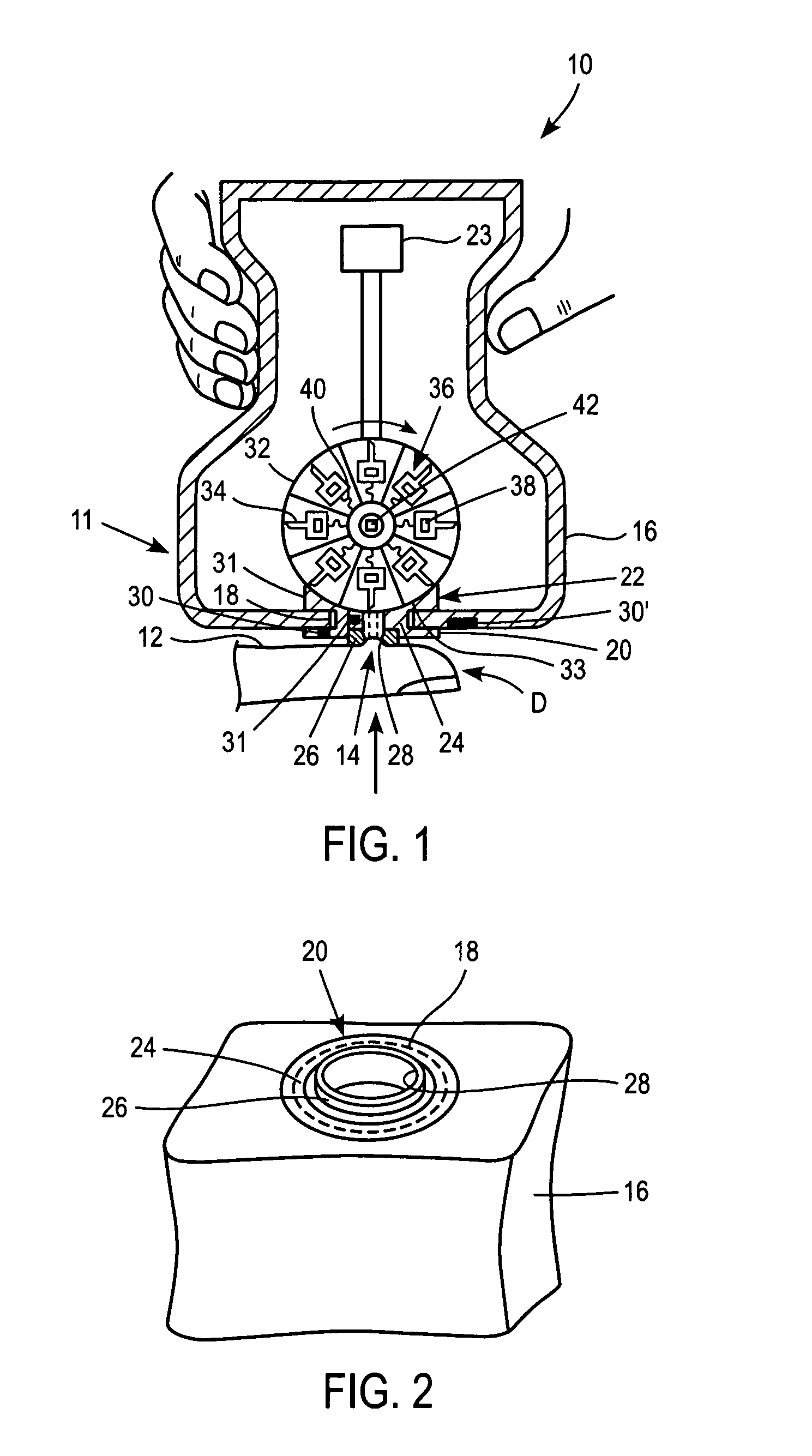

Electrical generator having an oscillator containing a freely moving internal element to improve generator effectiveness

InactiveUS7105939B2Motion thresholdImprove abilitiesAuxillariesMachines/enginesElectricityRechargeable cell

An apparatus and method for providing electrical energy to an electrical device by deriving the electrical energy from motion of the device. In one embodiment, the inventive apparatus includes a novel kinetic electrical power generator (KEPG) consisting of an inventive oscillating weight having an internal cavity with a freely movable acceleration element disposed therein, resulting in improved acceleration and oscillation capabilities and lower motion threshold for the weight, a system for converting the weight's oscillating motion into rotational motion, and an electromechanical transducer system for generating electrical energy from the rotational motion. The novel KEPG includes components for modifying the electrical energy for storing and / or feeding the modified electrical energy to the electrical device. Optional components may be included for using the modified electrical energy to recharge one or more rechargeable batteries used in an electric device. Alternate advantageous embodiments of the inventive apparatus include, but are not limited to: a KEPG with multiple inventive oscillating weights to increase velocity and frequency of desirable rotational motion, and a KEPG system utilizing multiple electrically coupled KEPG sub-systems.

Owner:POWER ESTIMATE

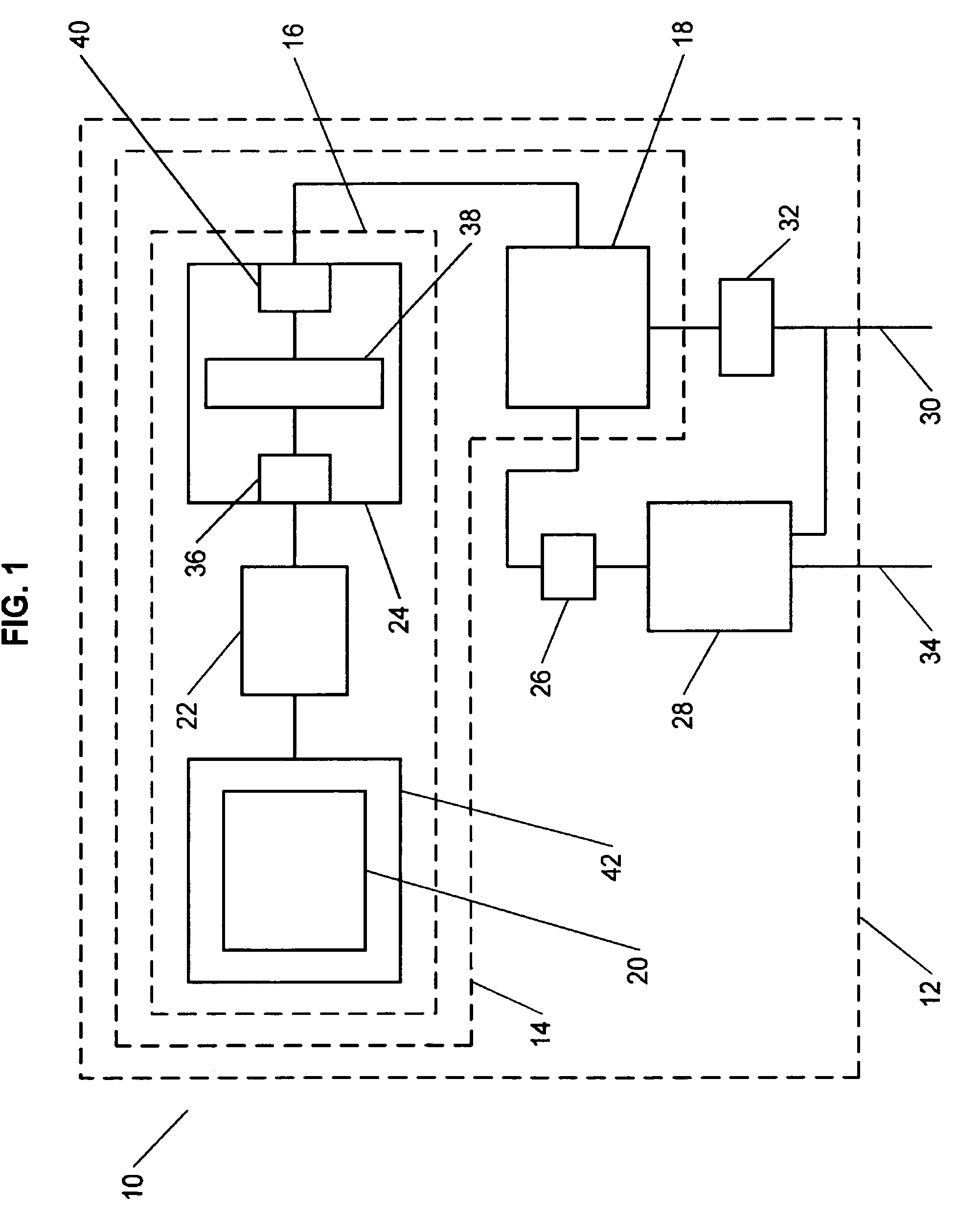

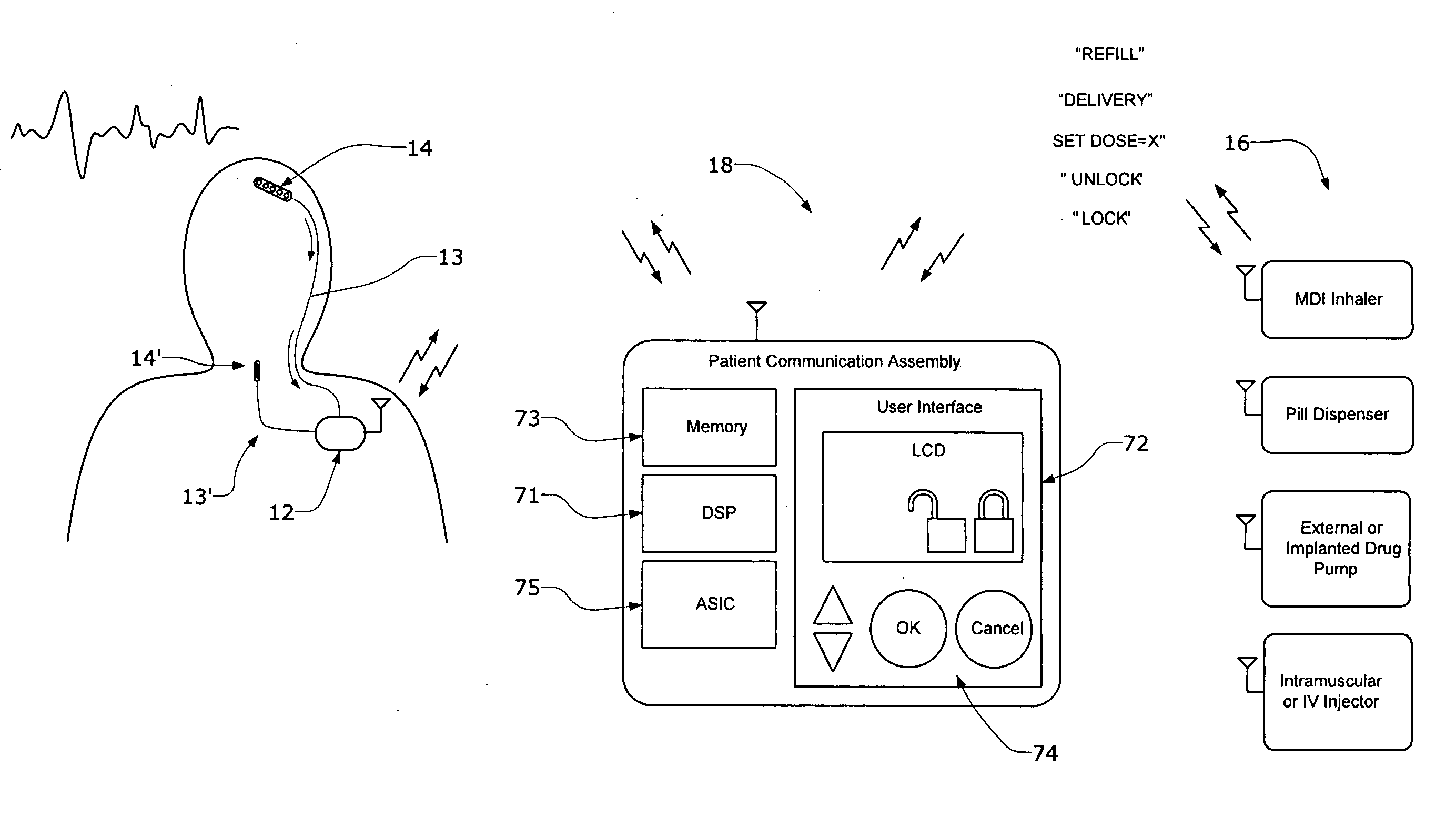

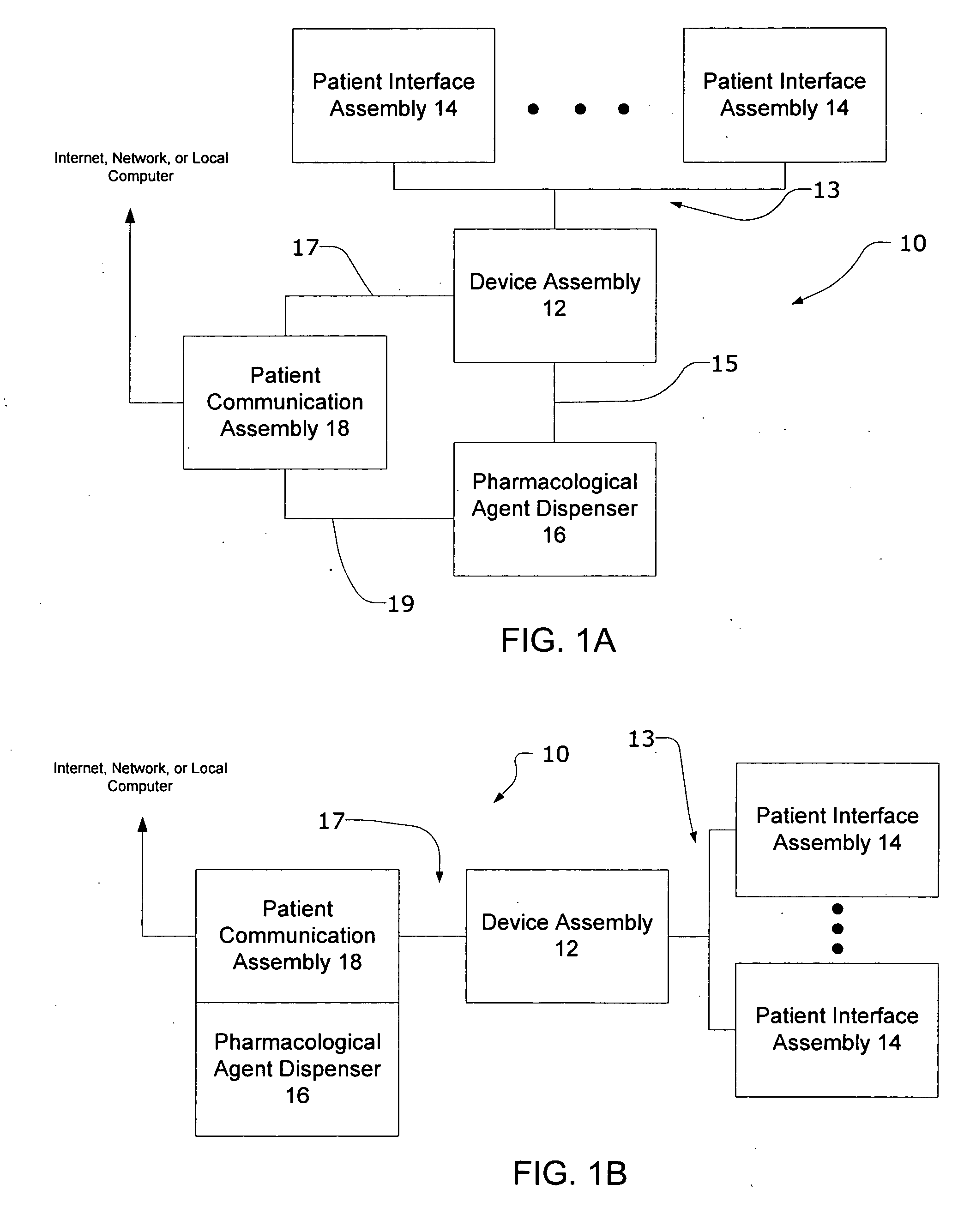

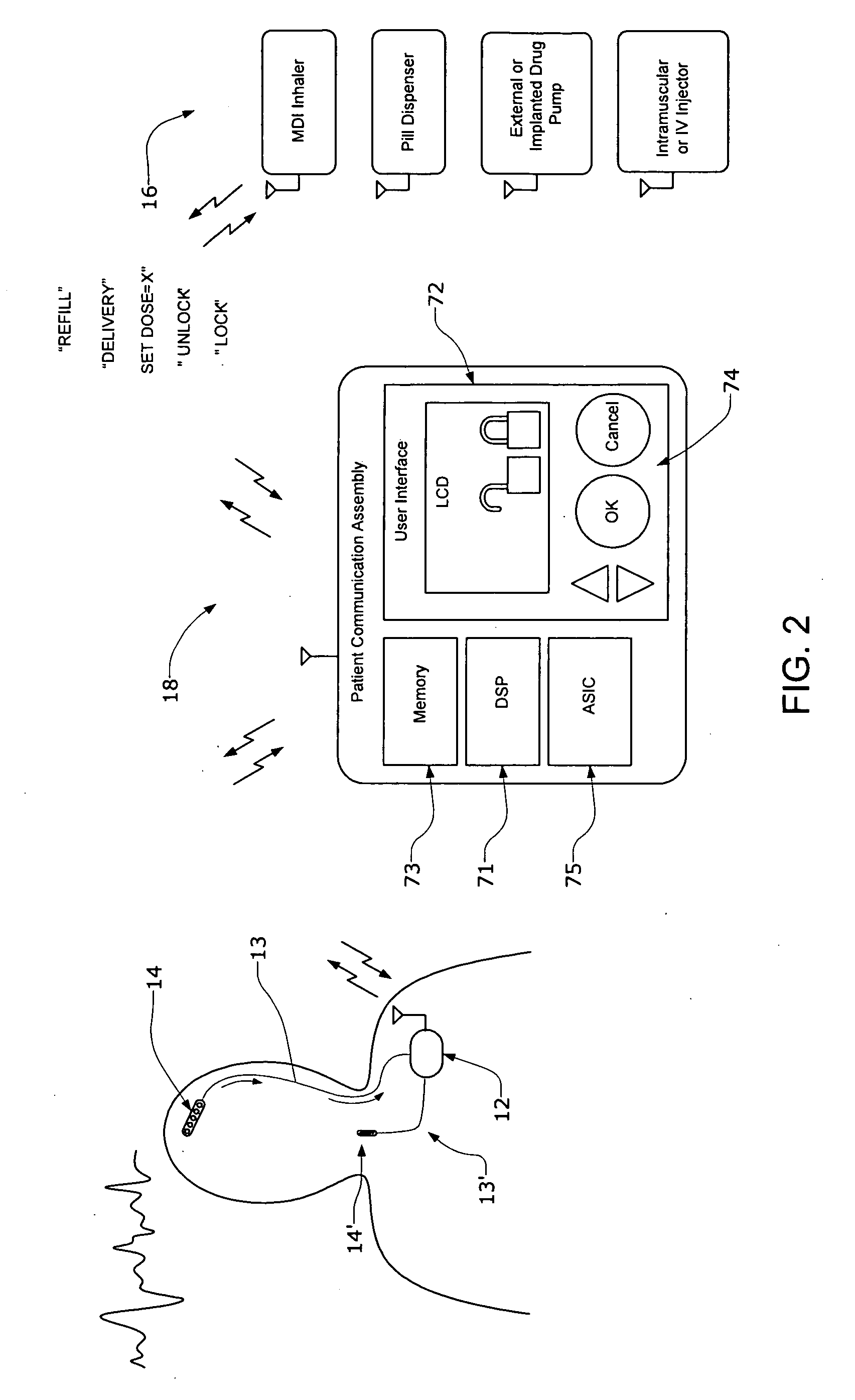

Systems and methods for characterizing a patient's propensity for a neurological event and for communicating with a pharmacological agent dispenser

InactiveUS20070149952A1Selectively limit accessSelectively limit to administrationDrug and medicationsTelemedicinePharmacometricsAntiepileptic drug

The present invention provides systems and methods for managing intake of a pharmacological agent. In one method of the present invention, the systems and methods are for controlling intake of an anti-epileptic drug. In such embodiments, one or more signals from a patient are processed to predict an onset of a seizure. Upon the prediction of the seizure, the patient is allowed to access the pharmacological agent in a pharmacological agent dispenser.

Owner:CYBERONICS INC

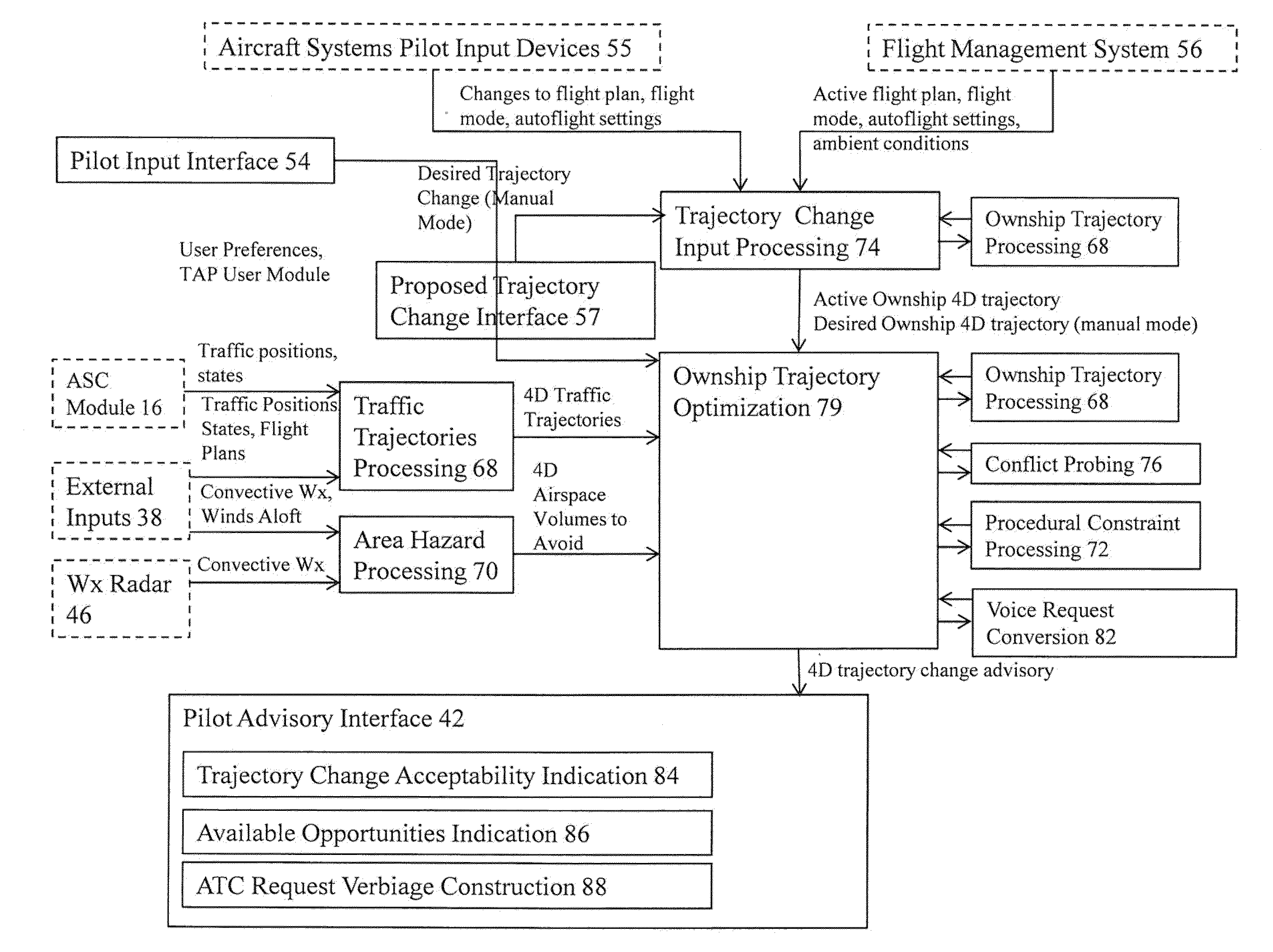

Method and Apparatus for Generating Flight-Optimizing Trajectories

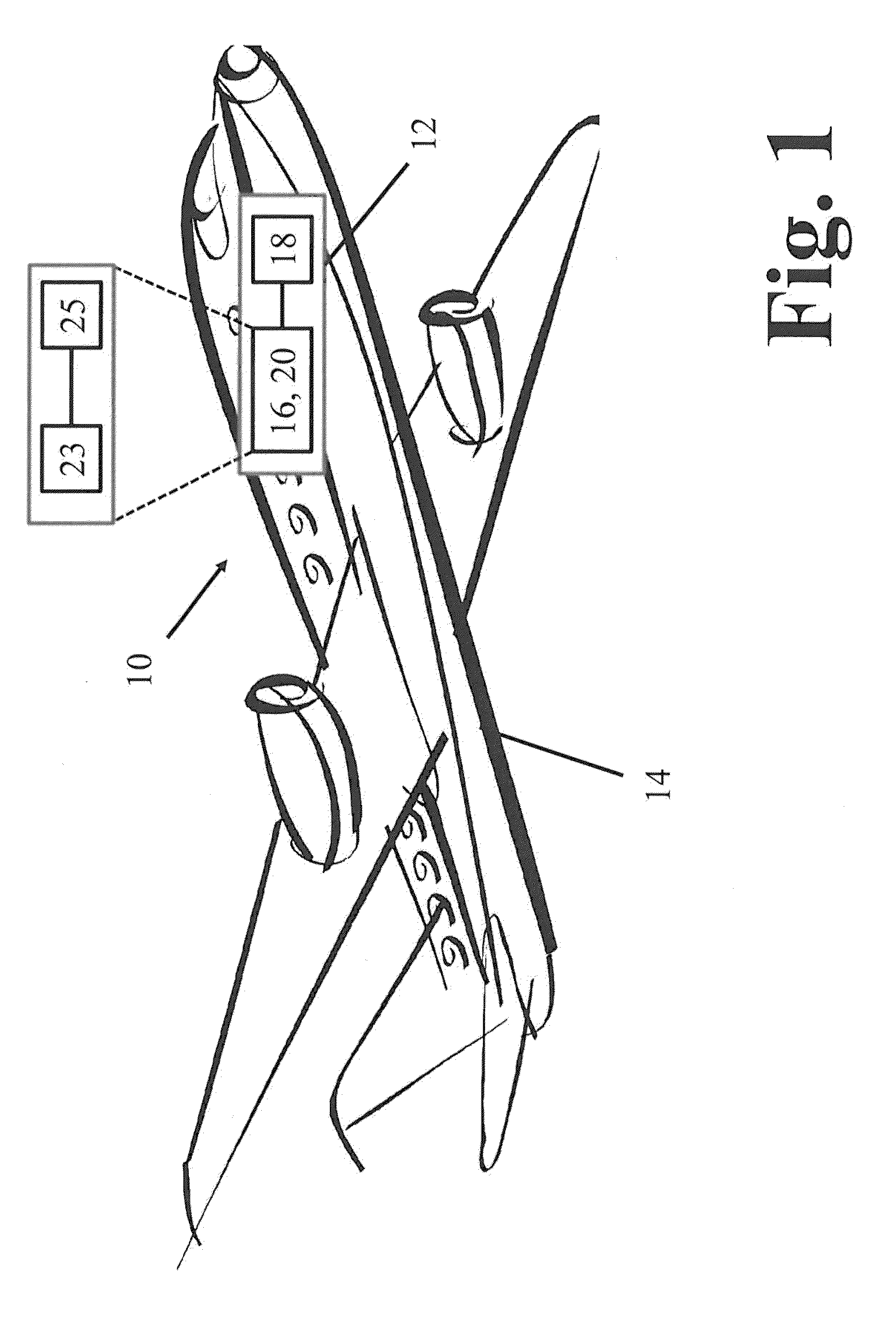

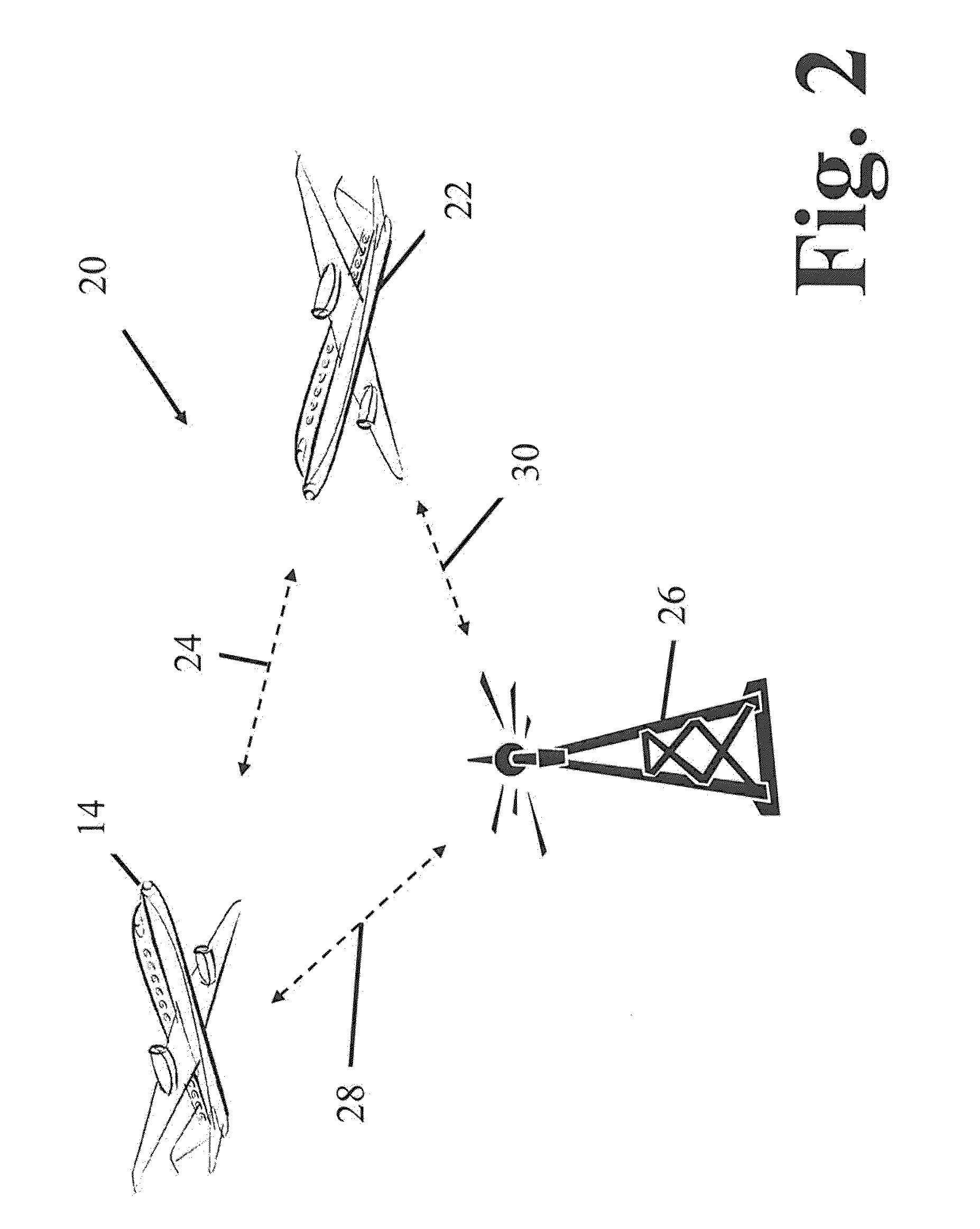

ActiveUS20130080043A1Raise the possibilityImprove efficiencyAnalogue computers for vehiclesEnergy saving arrangementsOn boardOptimal trajectory

An apparatus for generating flight-optimizing trajectories for a first aircraft includes a receiver capable of receiving second trajectory information associated with at least one second aircraft. The apparatus also includes a traffic aware planner (TAP) module operably connected to the receiver to receive the second trajectory information. The apparatus also includes at least one internal input device on board the first aircraft to receive first trajectory information associated with the first aircraft and a TAP application capable of calculating an optimal trajectory for the first aircraft based at least on the first trajectory information and the second trajectory information. The optimal trajectory at least avoids conflicts between the first trajectory information and the second trajectory information.

Owner:NASA

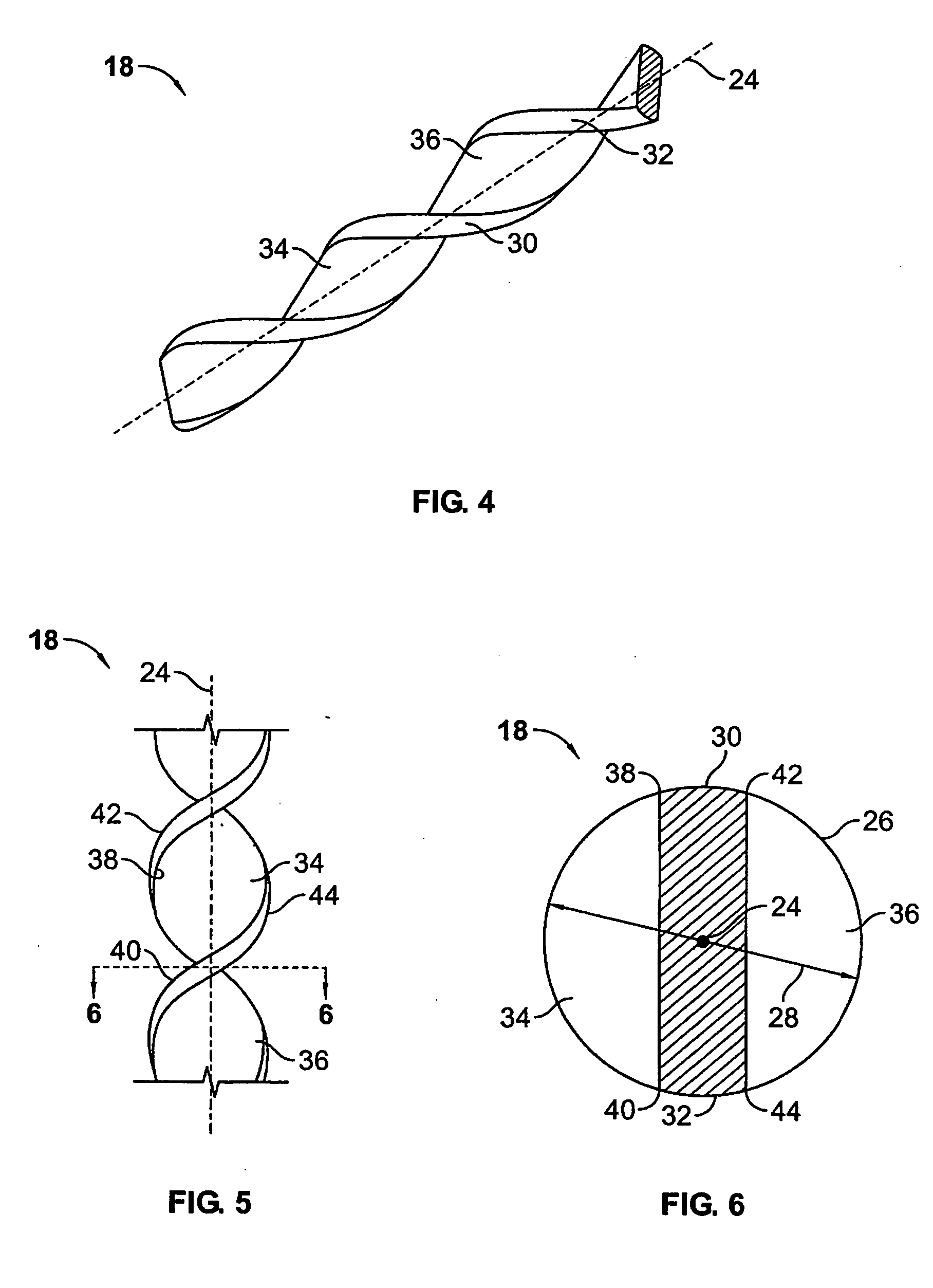

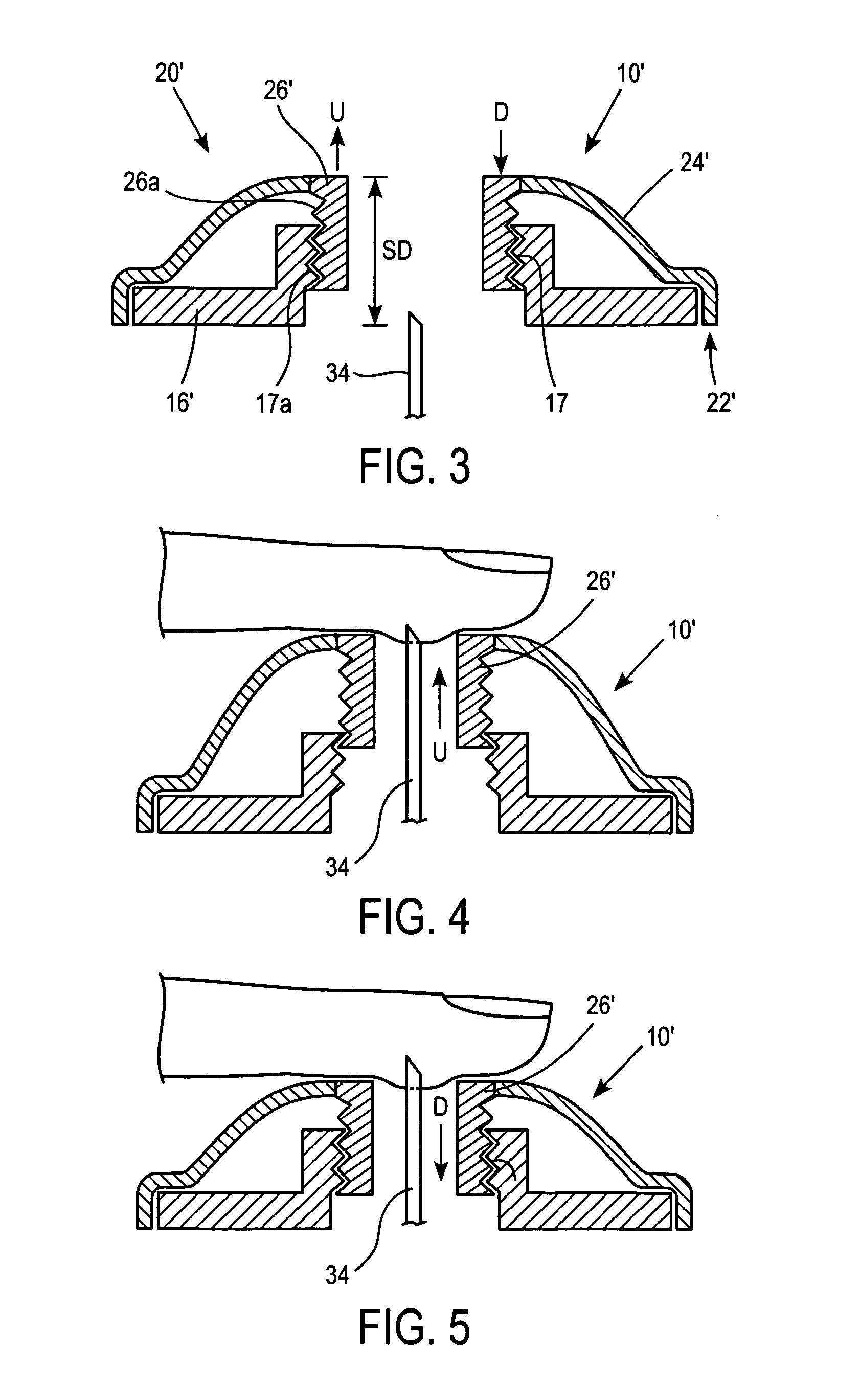

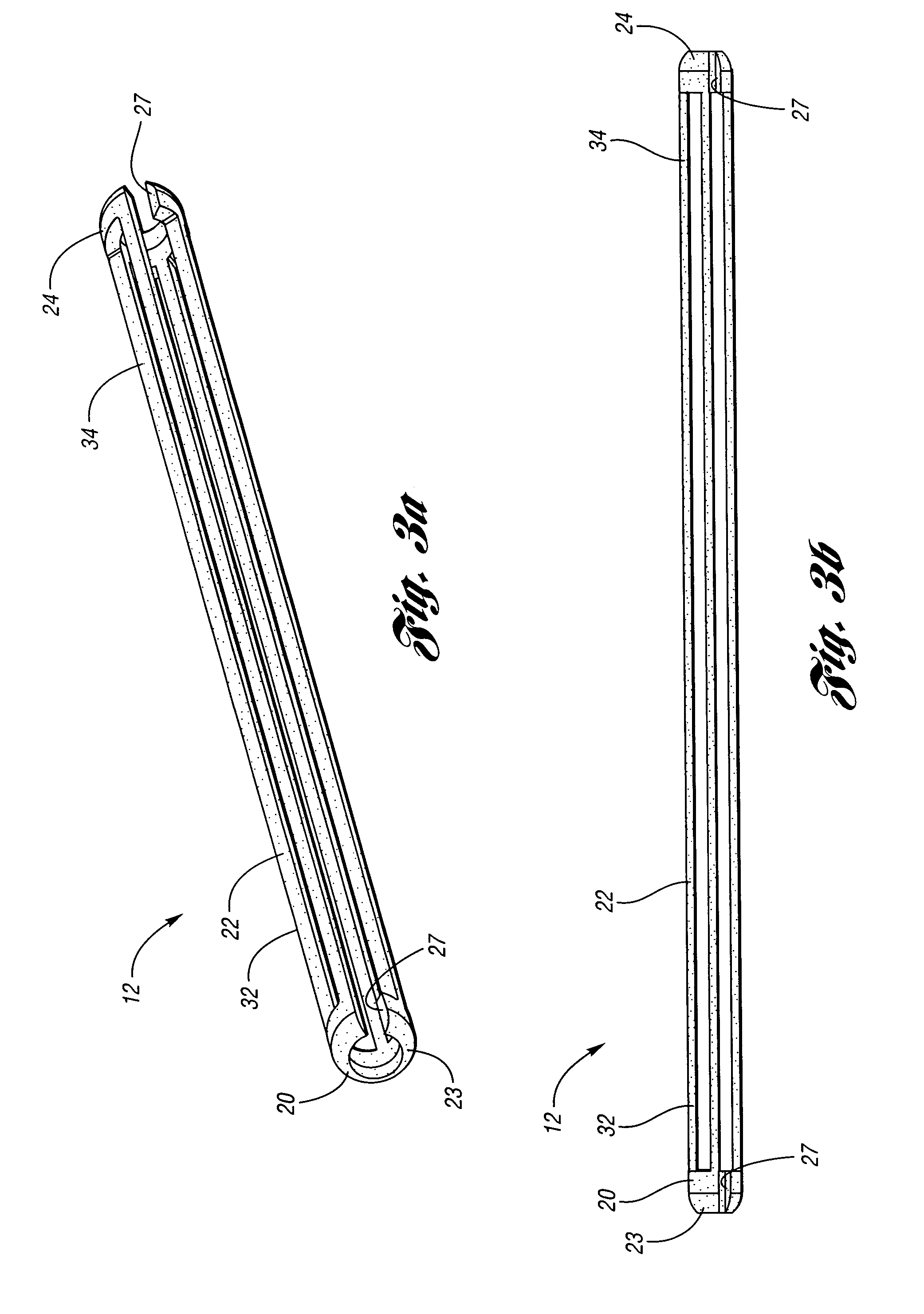

Dynamic spinal stabilizer

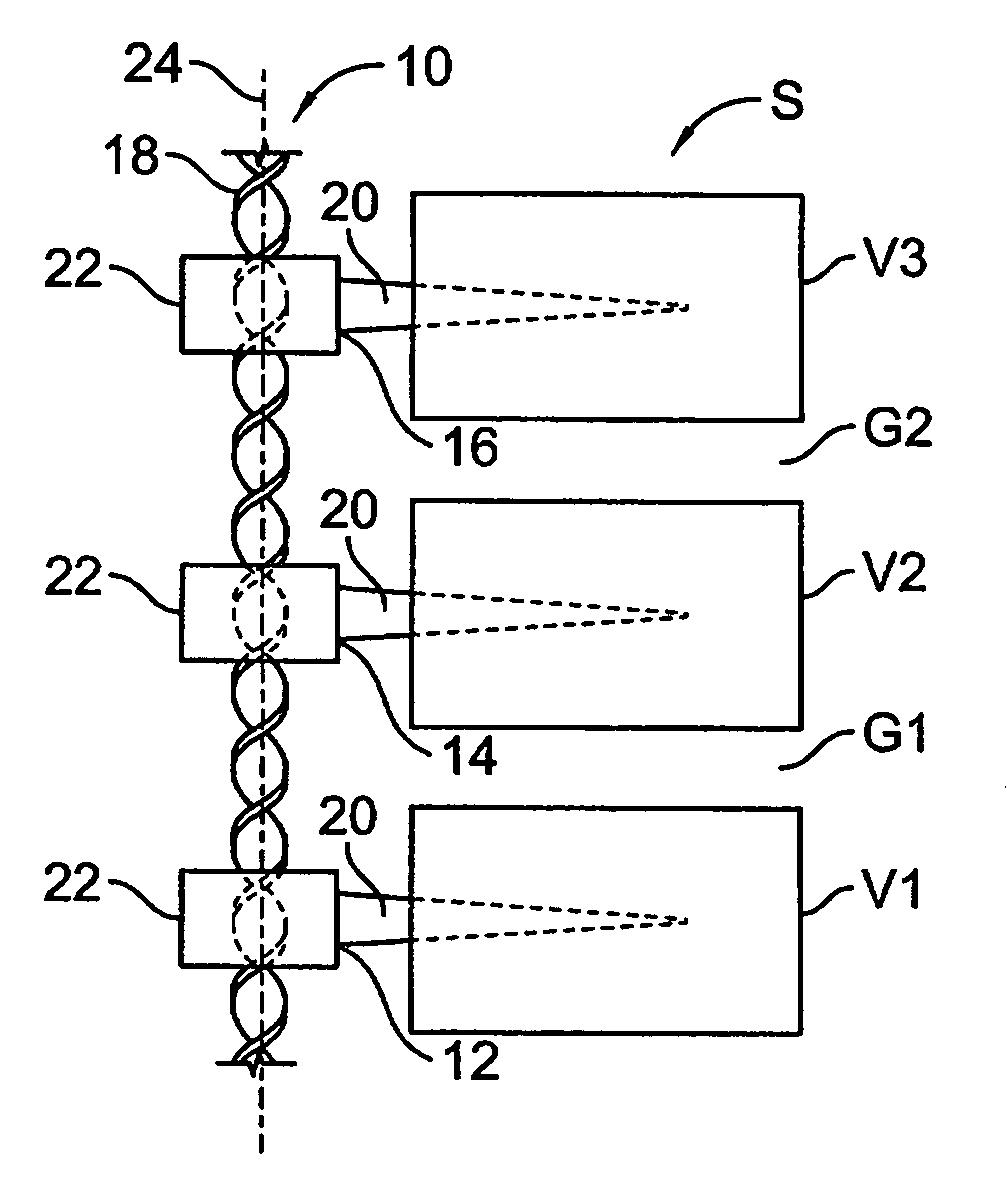

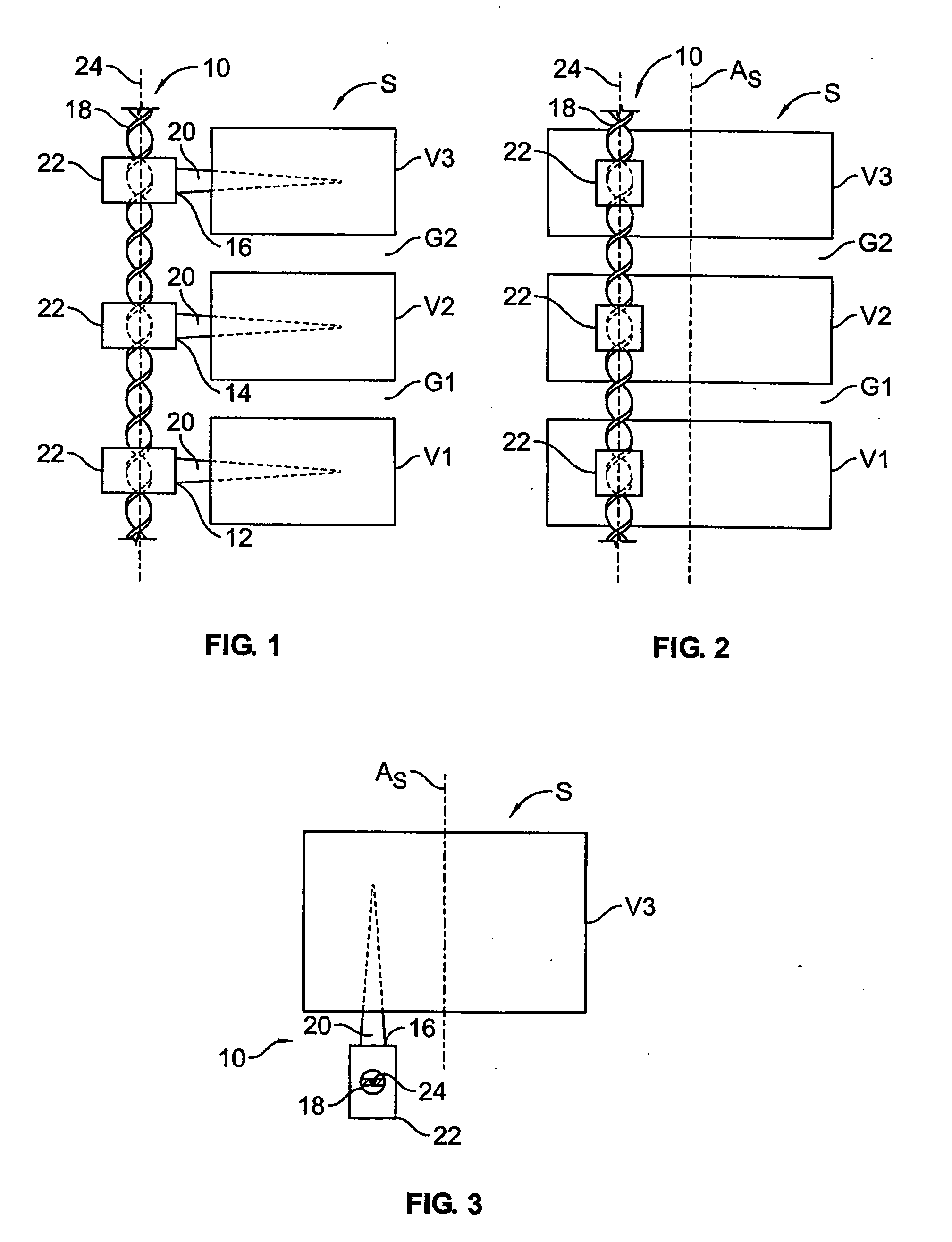

InactiveUS20070093815A1Substantial dimensional/diametrical stabilityIncrease likelihoodInternal osteosythesisJoint implantsPedicle screwBiomedical engineering

An elongated member forming a spinal support rod is implantable adjacent the spine of a patient and includes an axial span or spans for spanning respective spinal levels to promote efficacious spinal support / stabilization. The axial span manifests a double helical geometry. The axial span has a rod-like profile of a diameter similar to conventional spinal support rods used for lumbar spinal fusion, and provides for use across multiple spinal levels and with multiple adjustable attachment points for associated spine attachment devices, such as pedicle screws, to accommodate different patient anatomies.

Owner:APPLIED SPINE TECH

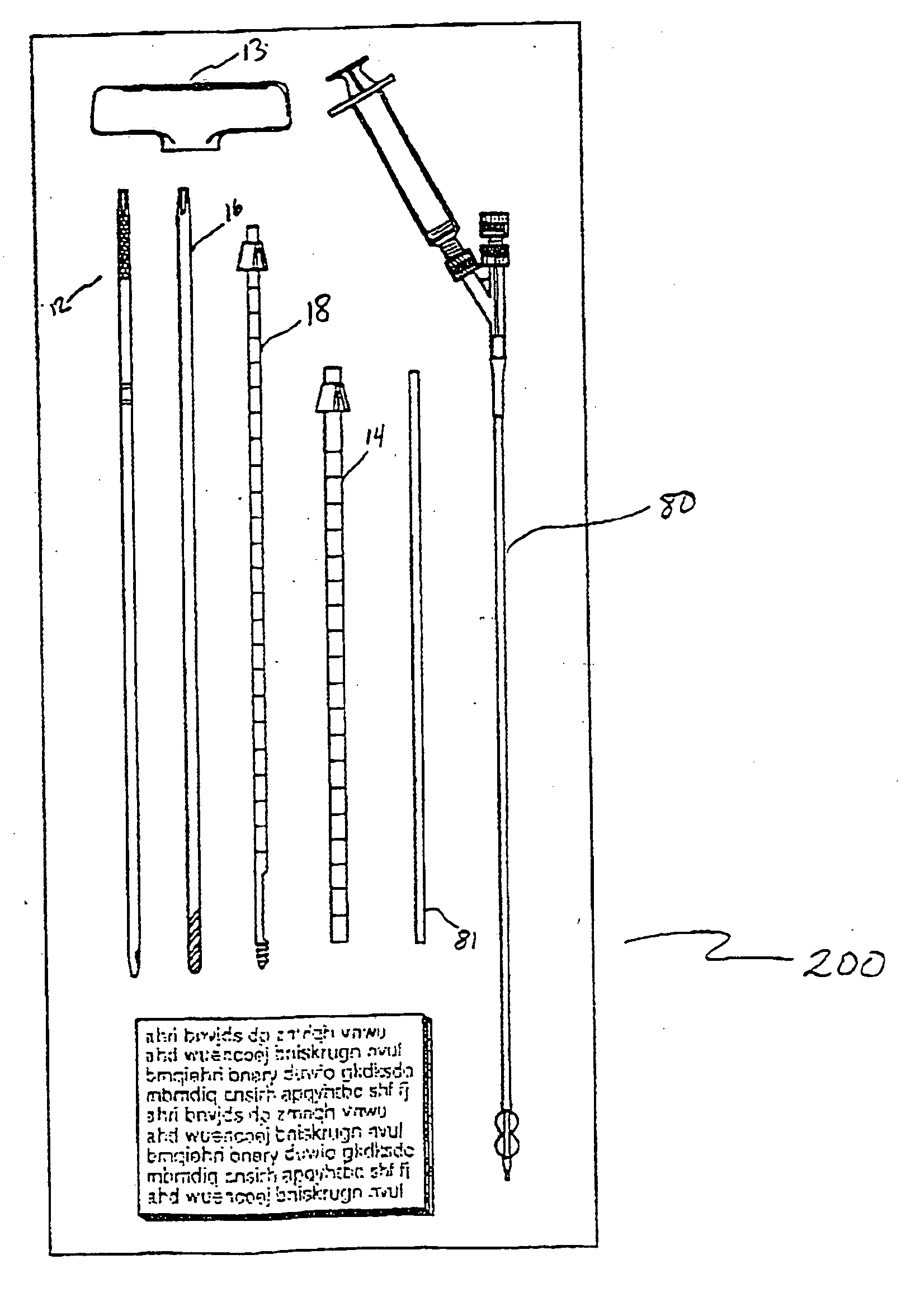

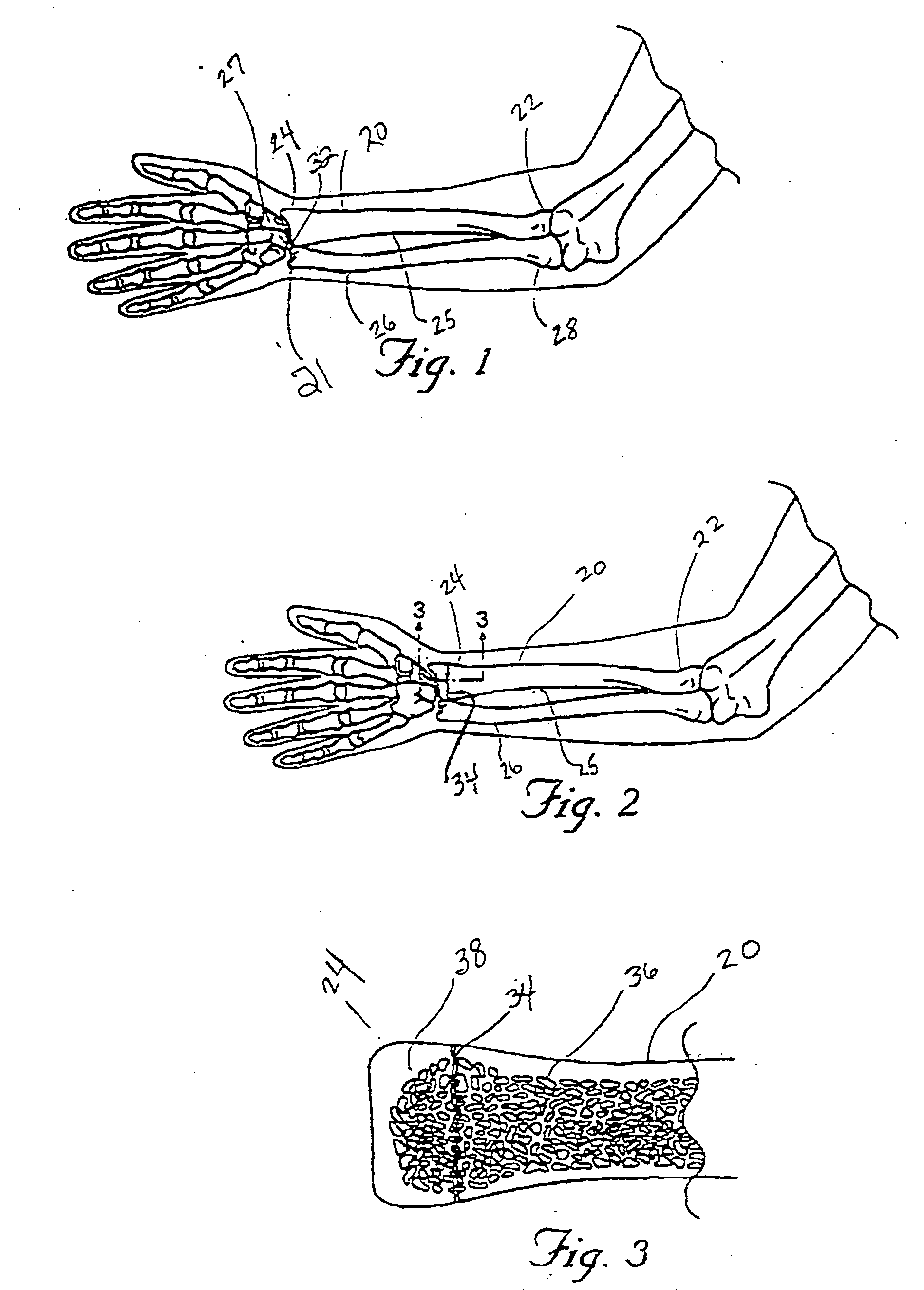

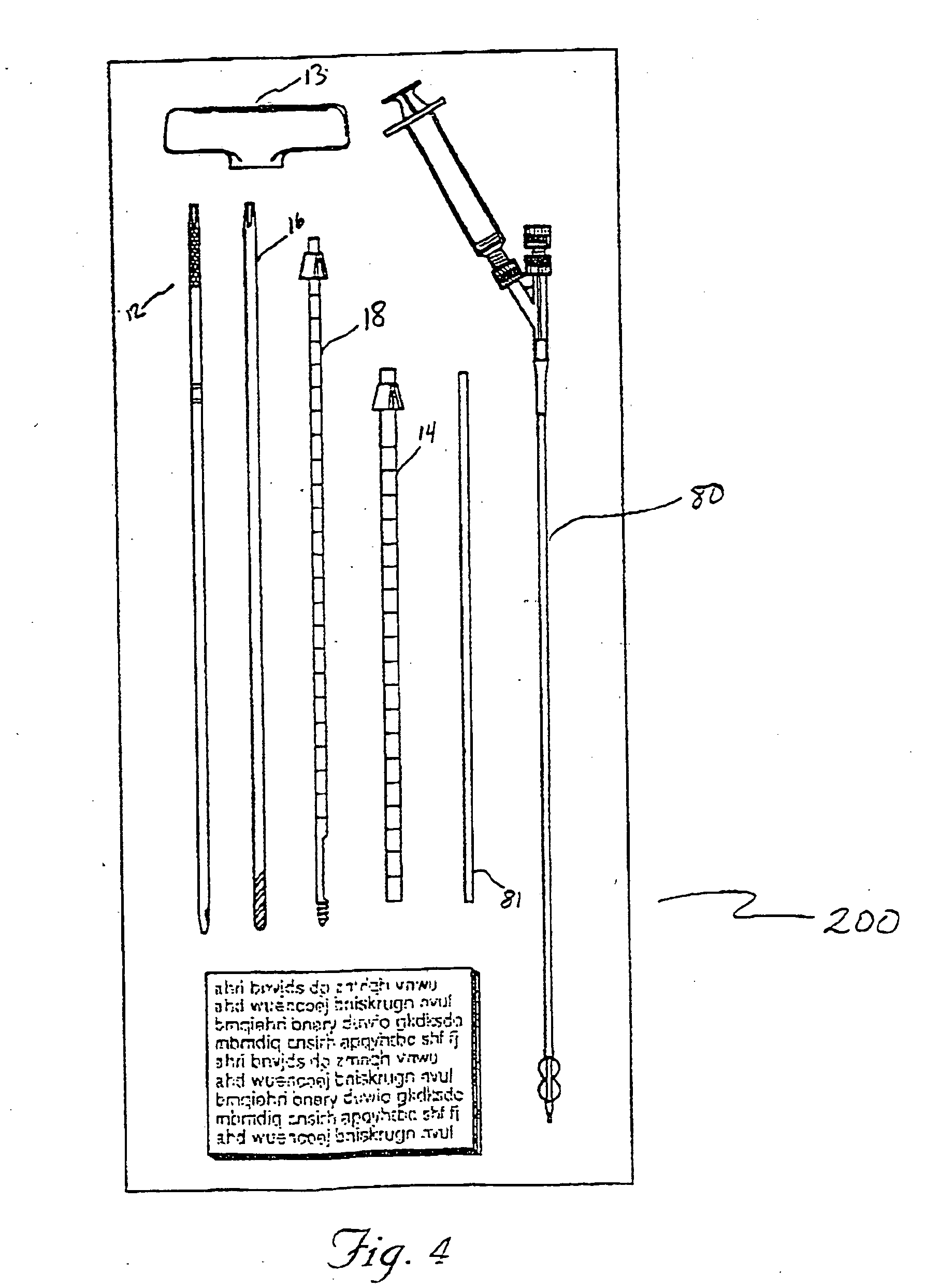

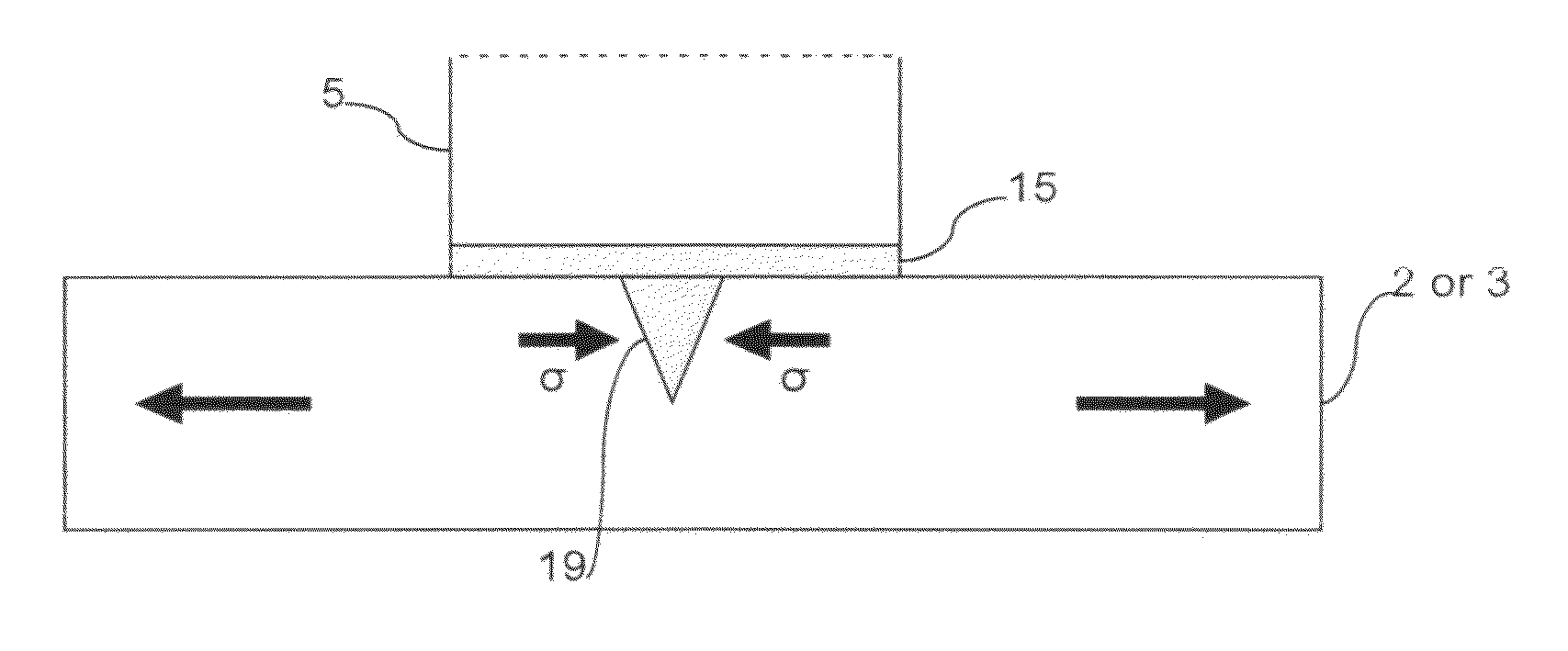

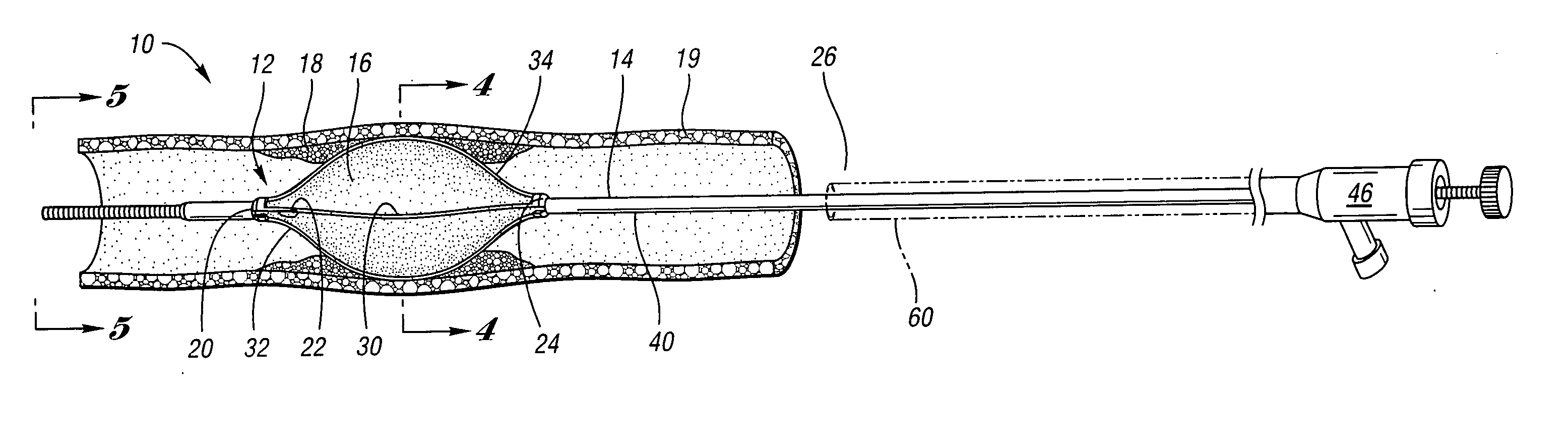

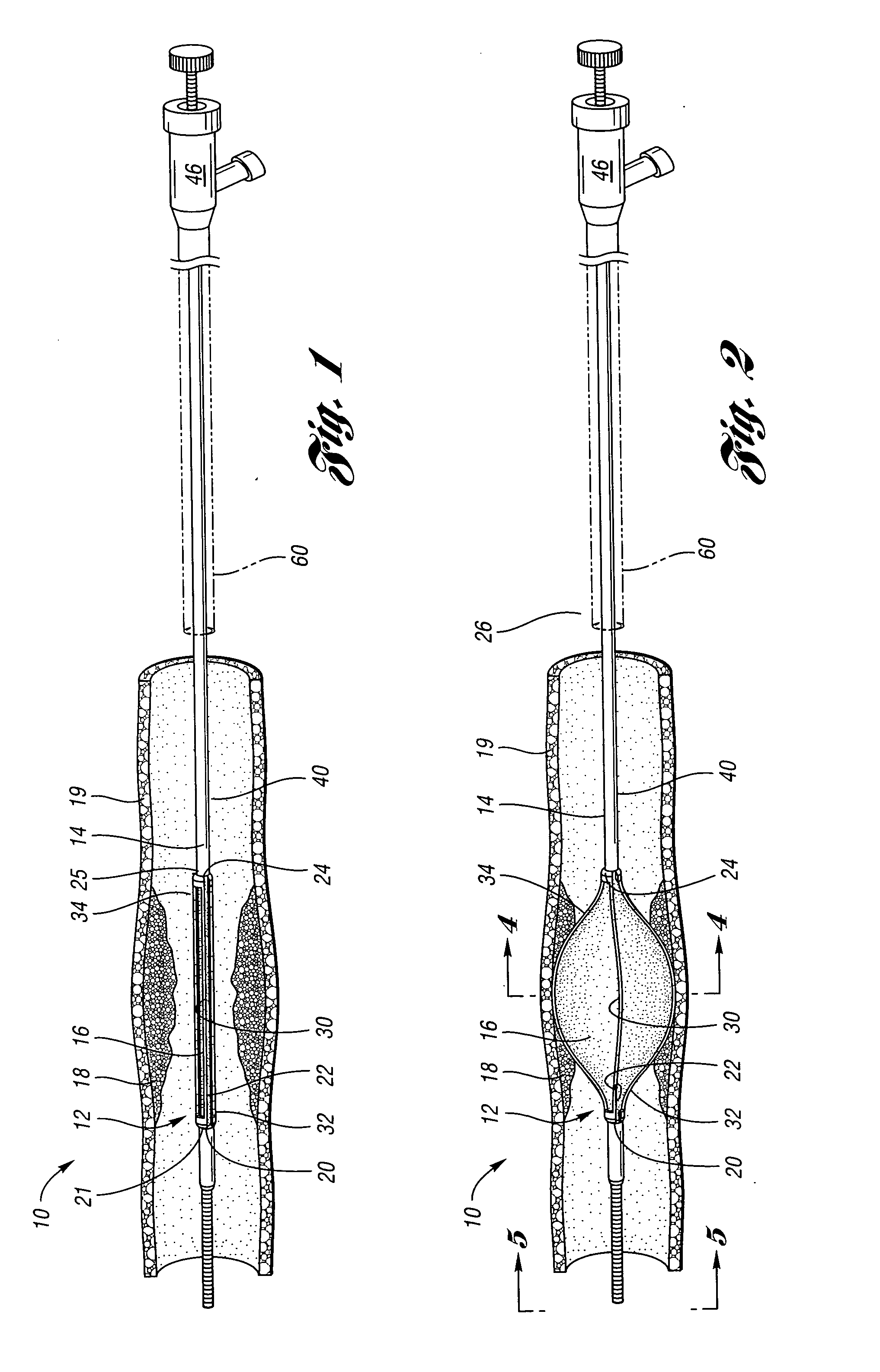

Systems and methods for reducing fractured bone using a fracture reduction cannula

InactiveUS20070118143A1Raise the possibilitySooner resumptionSurgical furnitureSurgical needlesFracture reductionMedicine

Systems and methods provide for the fixation of osteoporotic and non-osteoporotic long bones, especially Colles' fractures. A cannula having a circumferential opening is inserted into cancellous bone and directed such that the circumferential opening faces the fracture. The cannula is further adapted to receive an expandable structure, the expandable structure being inserted through the cannula until it is in registration with the circumferential opening. The expandable structure is expanded through the circumferential opening into cancellous bone and toward the fracture. The expansion of the expandable structure through the circumferential opening toward the fracture causes compression of cancellous bone and moves fractured cortical bone, thus creating a cavity proximal to the fracture. The cavity is then filled with a flowable bone filling material and the material allowed to harden.

Owner:ORTHOPHOENIX

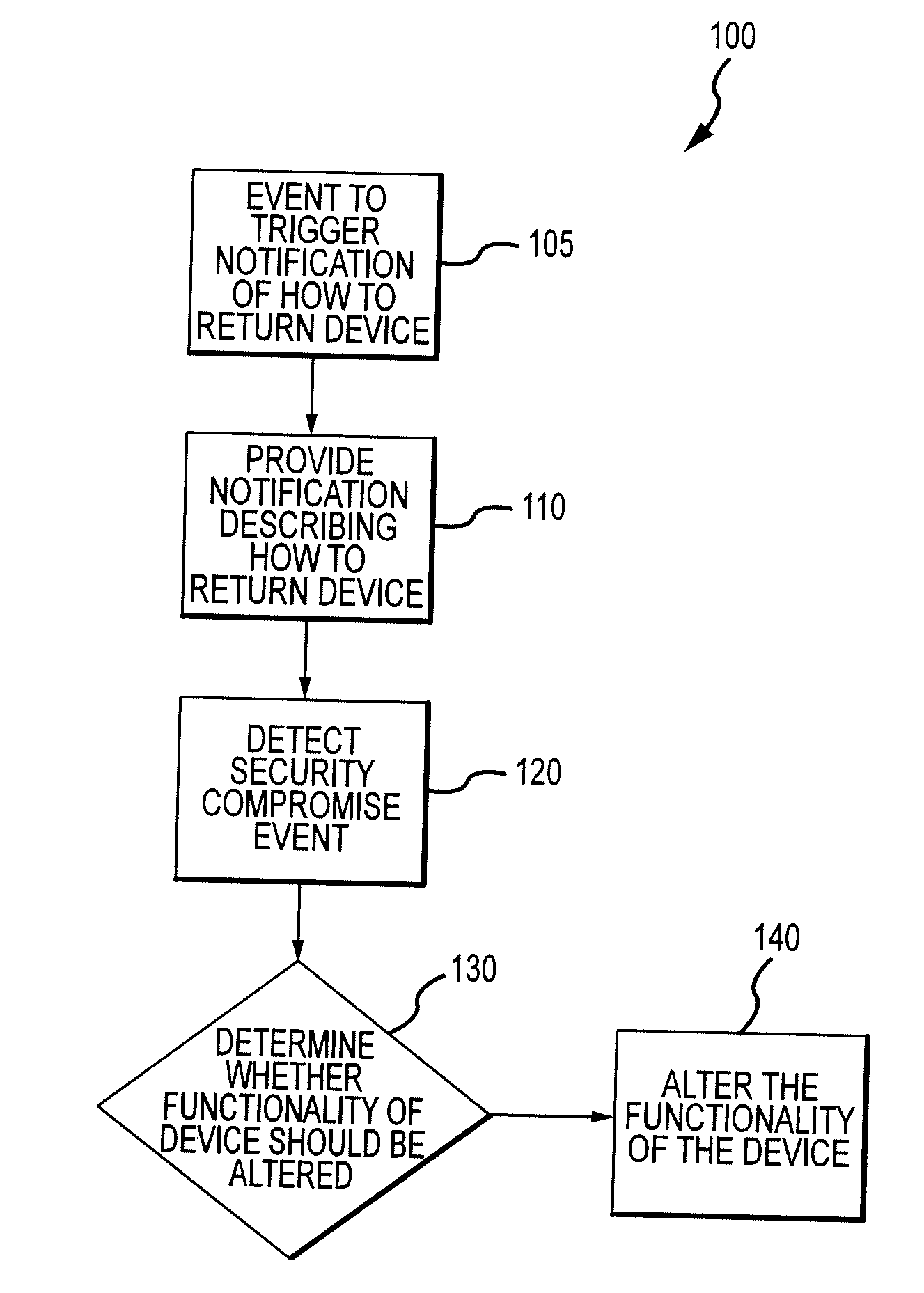

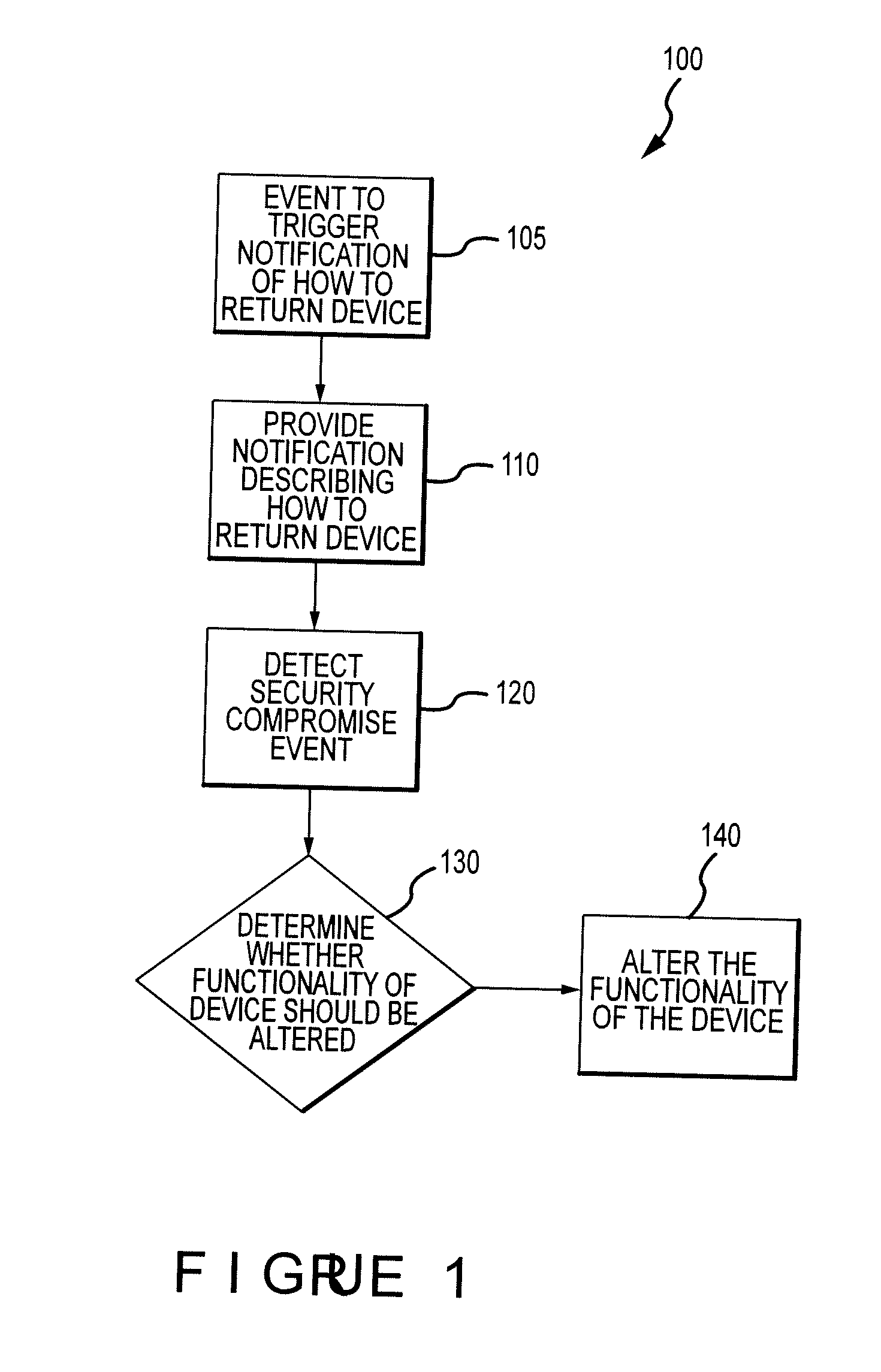

System for mitigating the unauthorized use of a device

ActiveUS20090251282A1Increase likelihoodIncreases chanceElectric signal transmission systemsMultiple keys/algorithms usageTesting equipmentComputer security

The invention is directed to systems and methods for detecting the loss, theft or unauthorized use of a device and / or altering the functionality of the device in response. In one embodiment, a device monitors its use, its local environment, and / or its operating context to determine that the device is no longer within the control of an authorized user. The device may receive communications or generate an internal signal altering its functionality, such as instructing the device to enter a restricted use mode, a surveillance mode, to provide instructions to return the device and / or to prevent unauthorized use or unauthorized access to data. Additional embodiments also address methods and systems for gathering forensic data regarding an unauthorized user to assist in locating the unauthorized user and / or the device.

Owner:BLANCCO TECH GRP IP OY

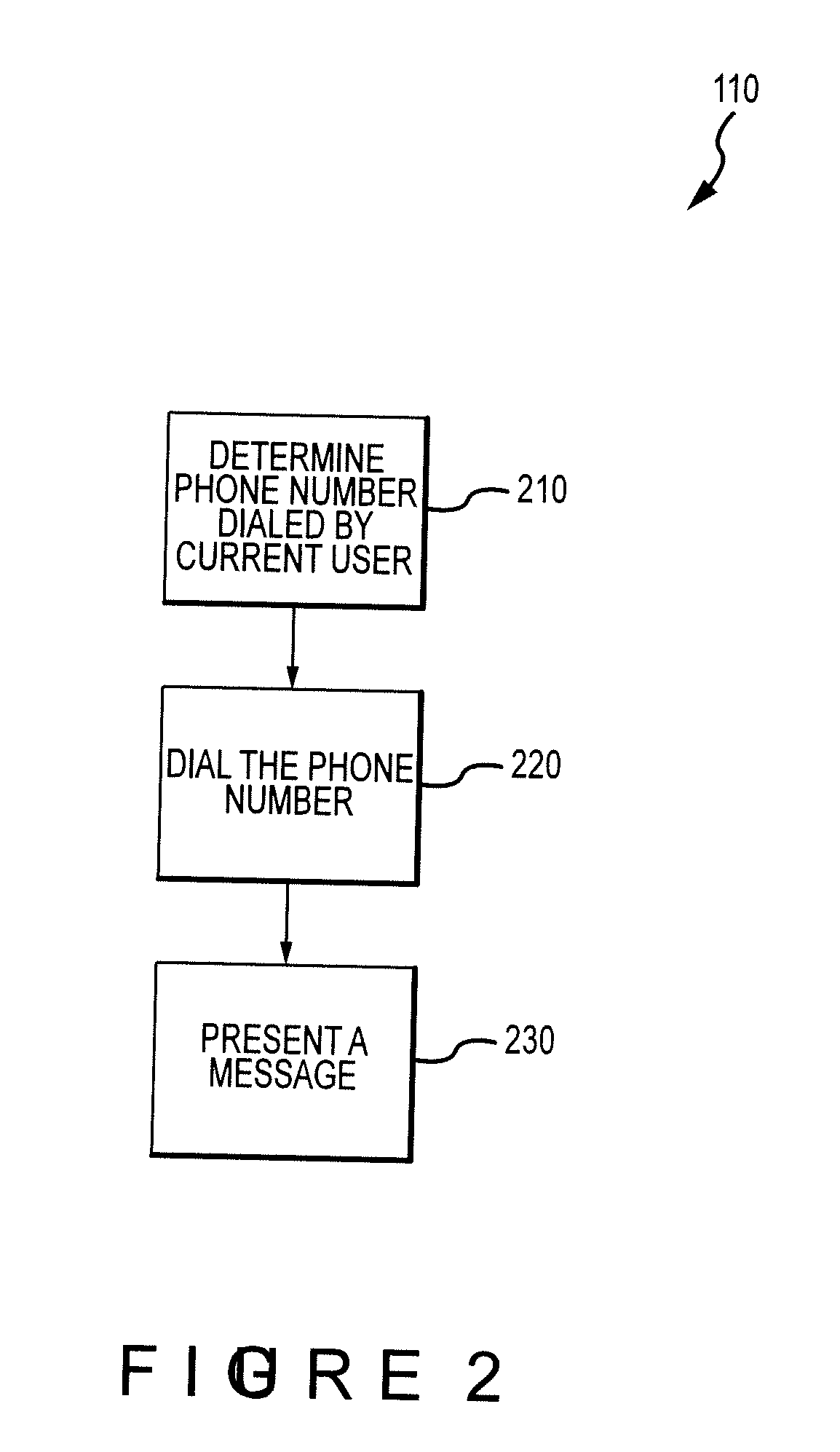

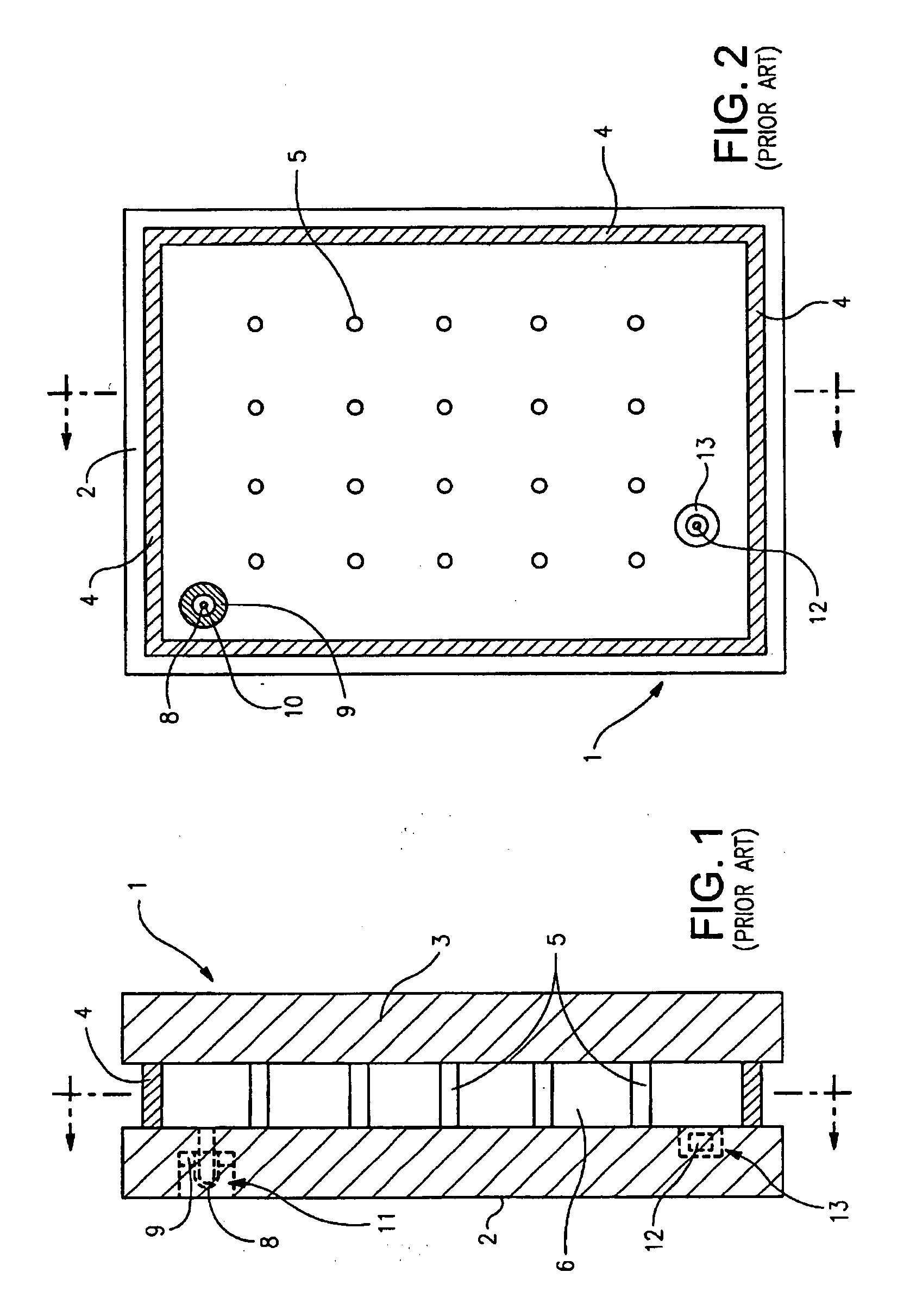

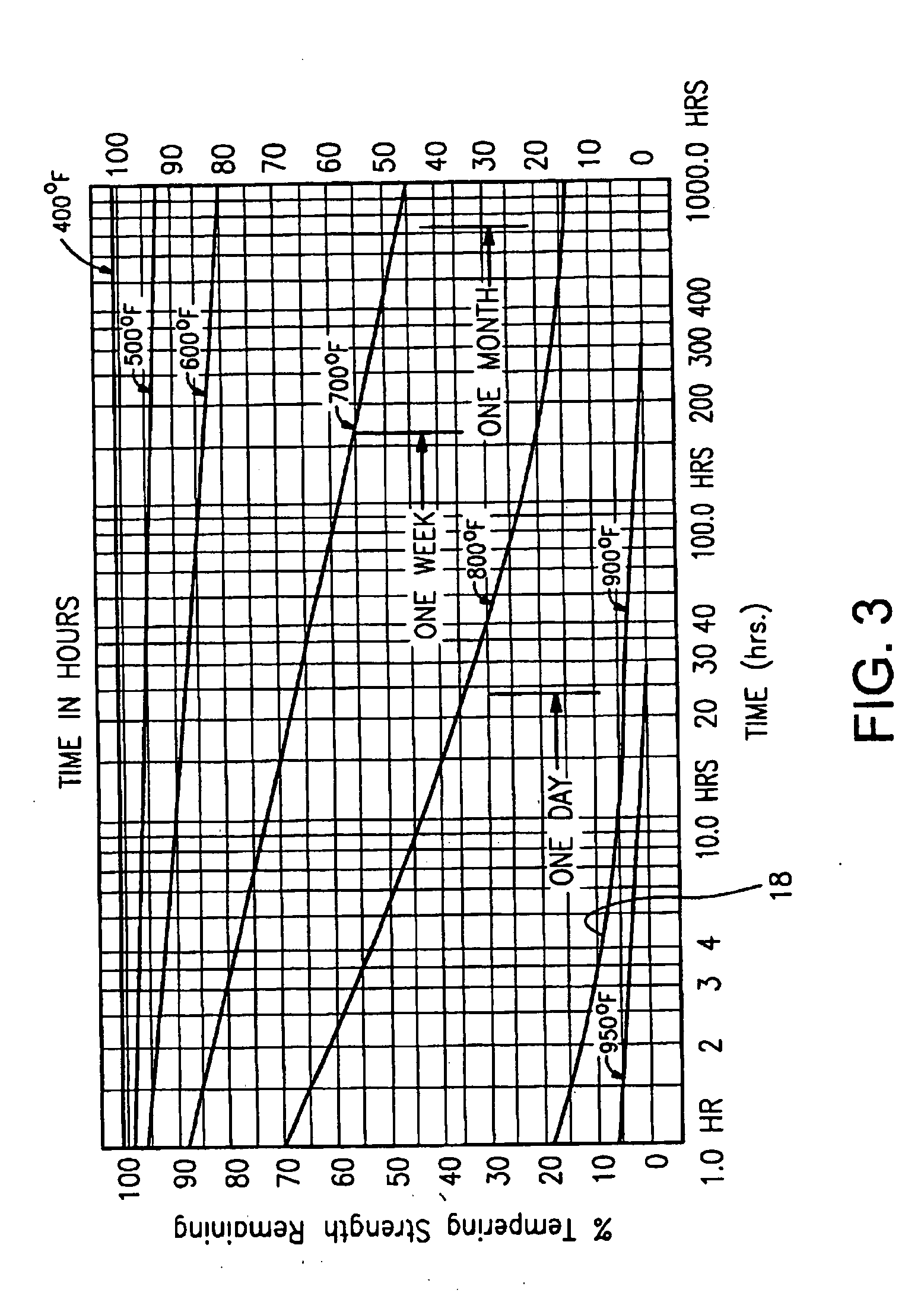

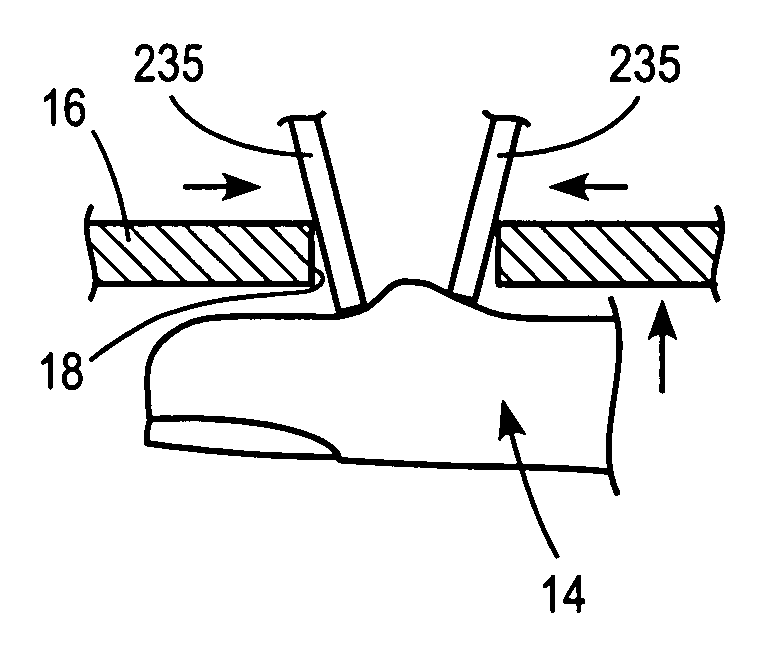

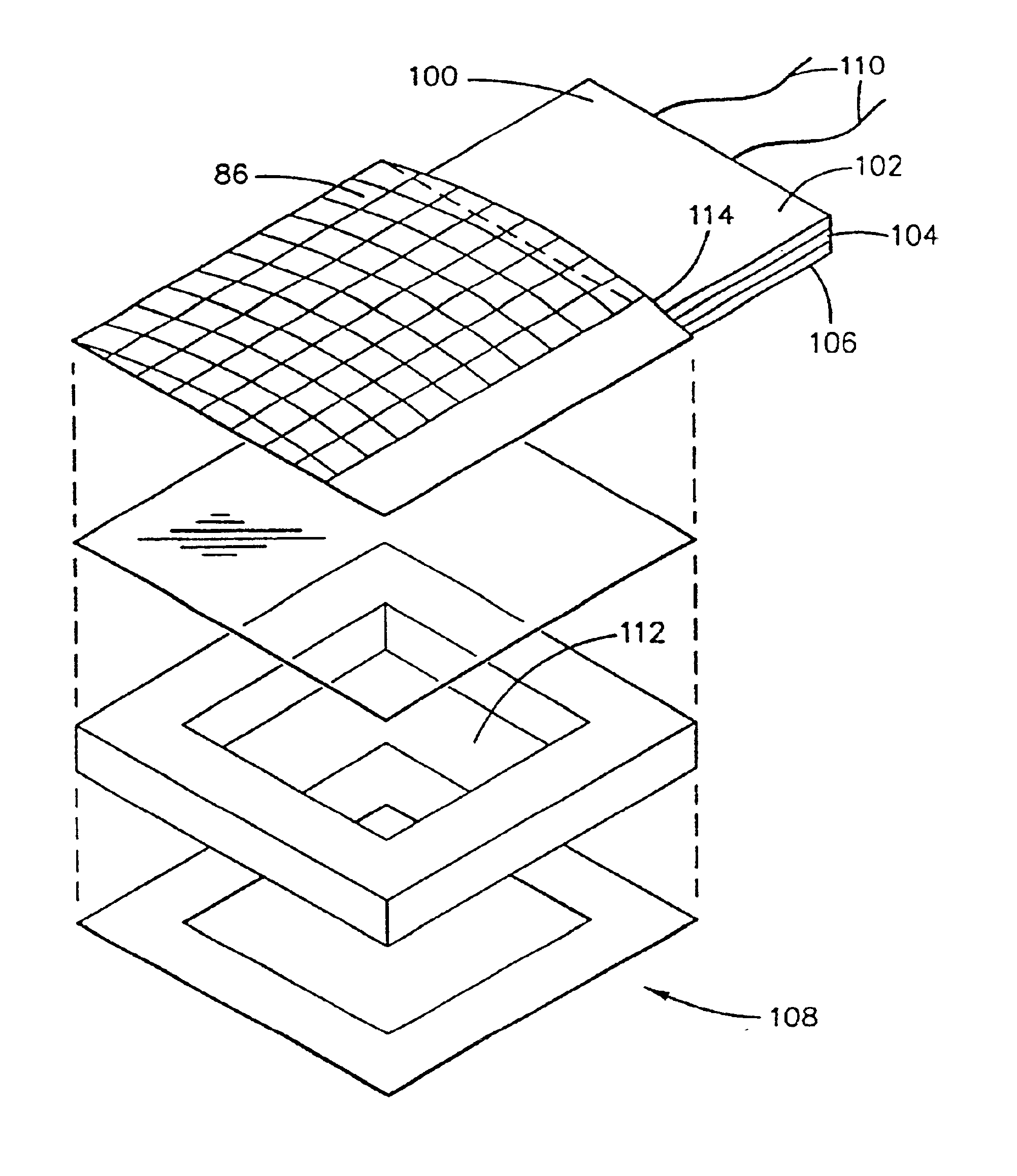

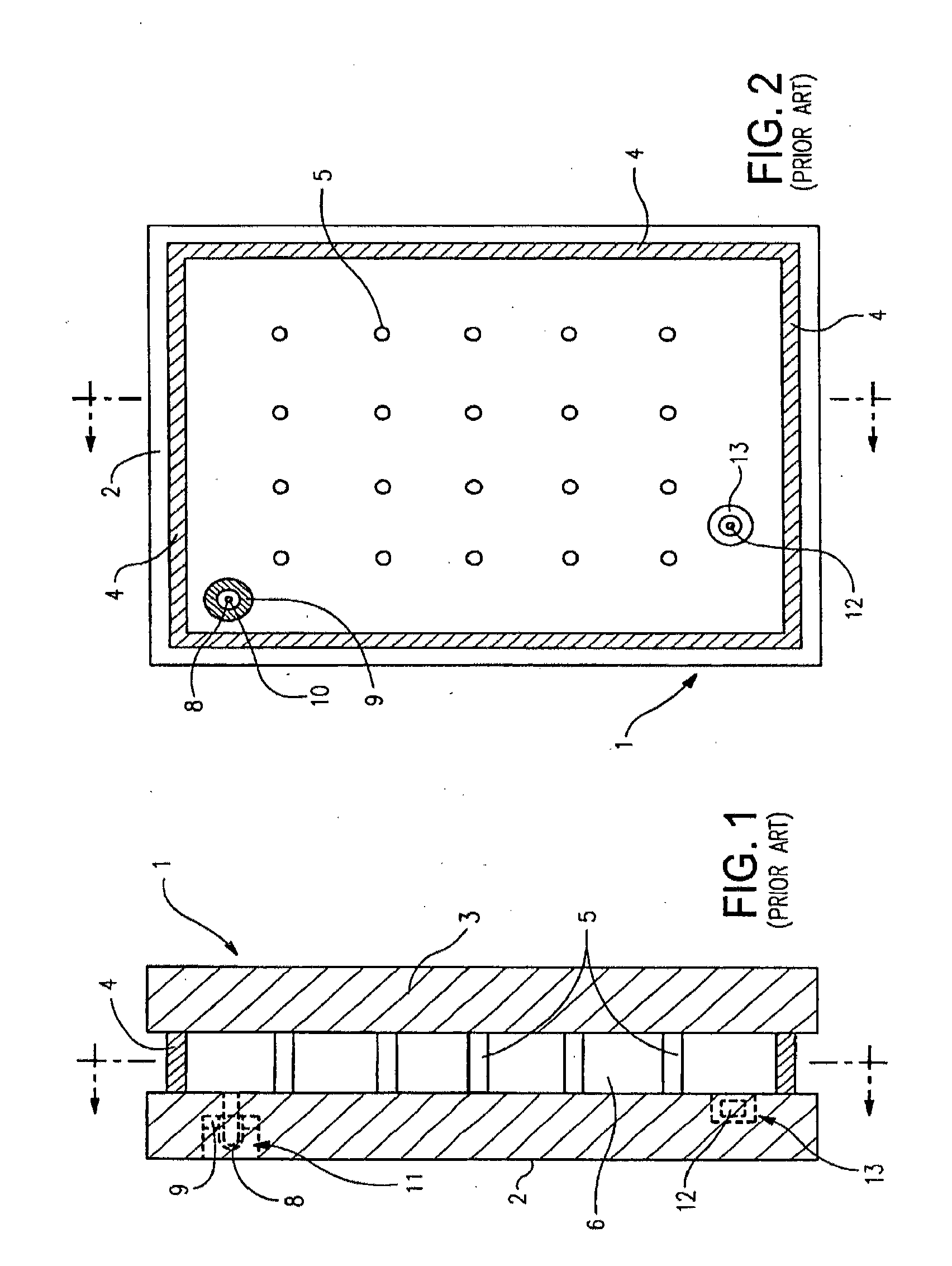

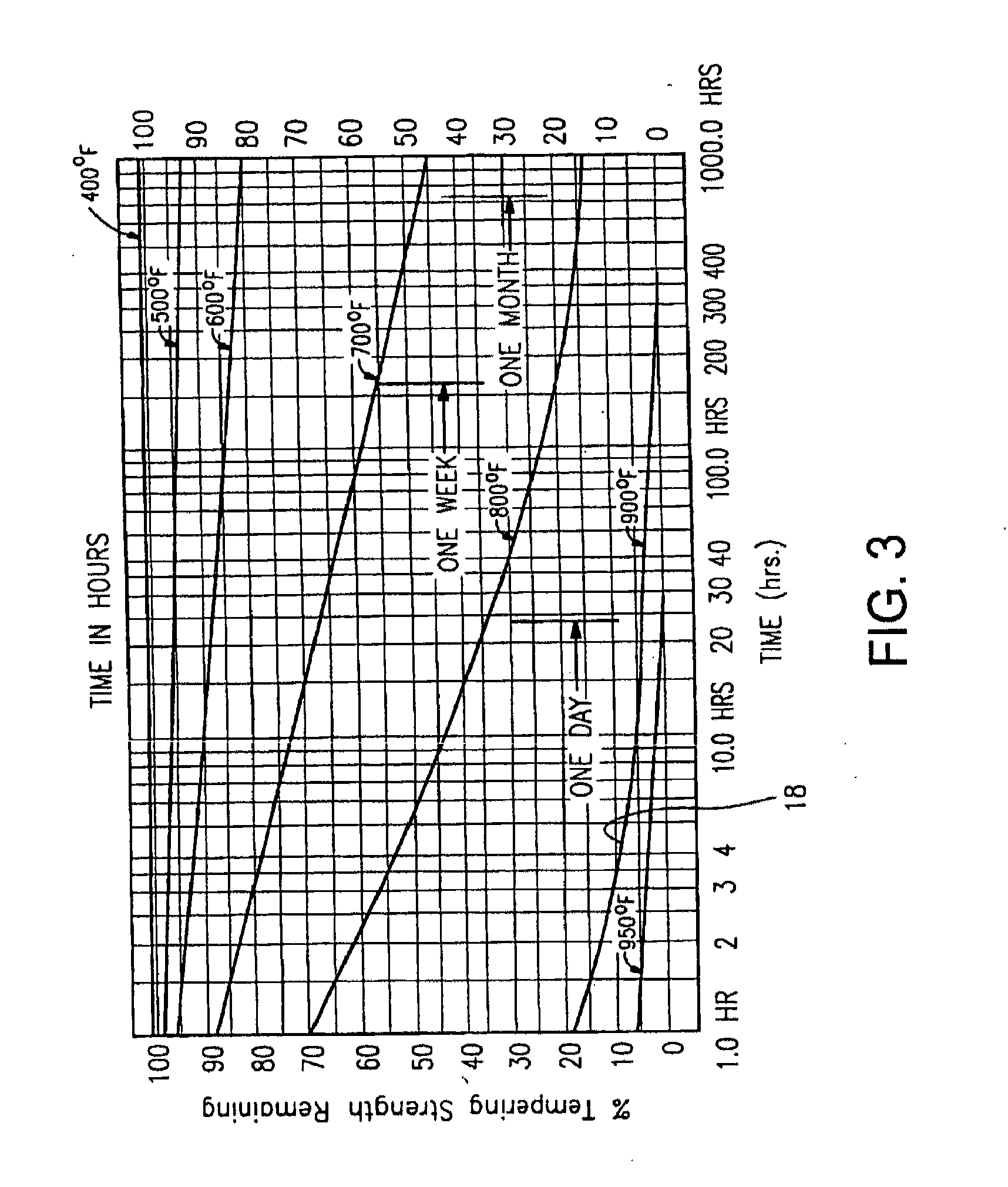

Localized heating via an infrared heat source array of edge seals for a vacuum insulating glass unit, and/or unitized oven with infrared heat source array for accomplishing the same

ActiveUS20090151855A1Lower temperatureIncrease likelihood of deformationClimate change adaptationLaminationEngineeringThermal source

Certain example embodiments of this invention relate to edge sealing techniques for vacuum insulating glass (VIG) units. More particularly, certain example embodiments relate to techniques for providing localized heating to edge seals of units, and / or unitized ovens for accomplishing the same. In certain example embodiments, a unit is pre-heated to one or more intermediate temperatures, localized heating via at least one substantially two-dimensional array of heat sources is provided proximate to the peripheral edges of the unit so as to melt frits placed thereon, and cooled. In certain non-limiting implementations, the pre-heating and / or cooling may be provided in one or more steps. An oven for accomplishing the same may include multiple zones for performing the above-noted steps, each zone optionally including one or more chambers. Accordingly, in certain example embodiments, a temperature gradient proximate to the edges of the unit is created, thereby reducing the chances of breakage and / or at least some de-tempering of the substrates.

Owner:GUARDIAN GLASS LLC

Body fluid sampling device - sampling site interface

ActiveUS20100010374A1Increase likelihoodReduction or mitigation of pain sensationIntravenous devicesDiagnostic recording/measuringSkin penetrationBiomedical engineering

An arrangement for producing a sample of body fluid from a wound opening created in a skin surface at a sampling site includes: a housing, the housing comprising a first opening; a skin interface member disposed in the first opening, the skin interface member comprising an inner member having a second opening, and an outer member at least partially surrounding the inner member and attached to the first opening; and at least one skin-penetration member configured and arranged to project within the second opening. Arrangements having alternatively constructed skin interface members are also described.

Owner:INTUITY MEDICAL INC

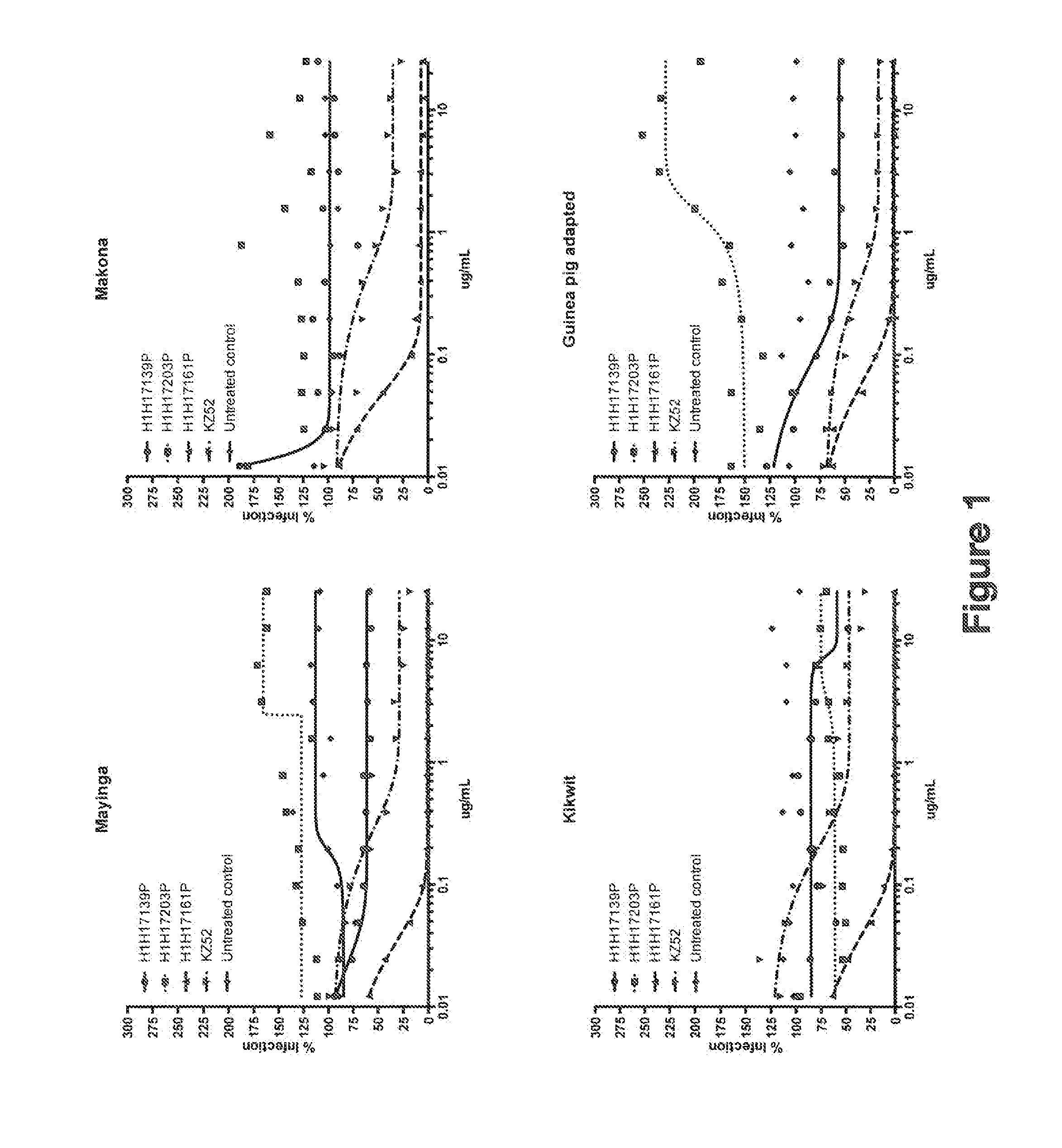

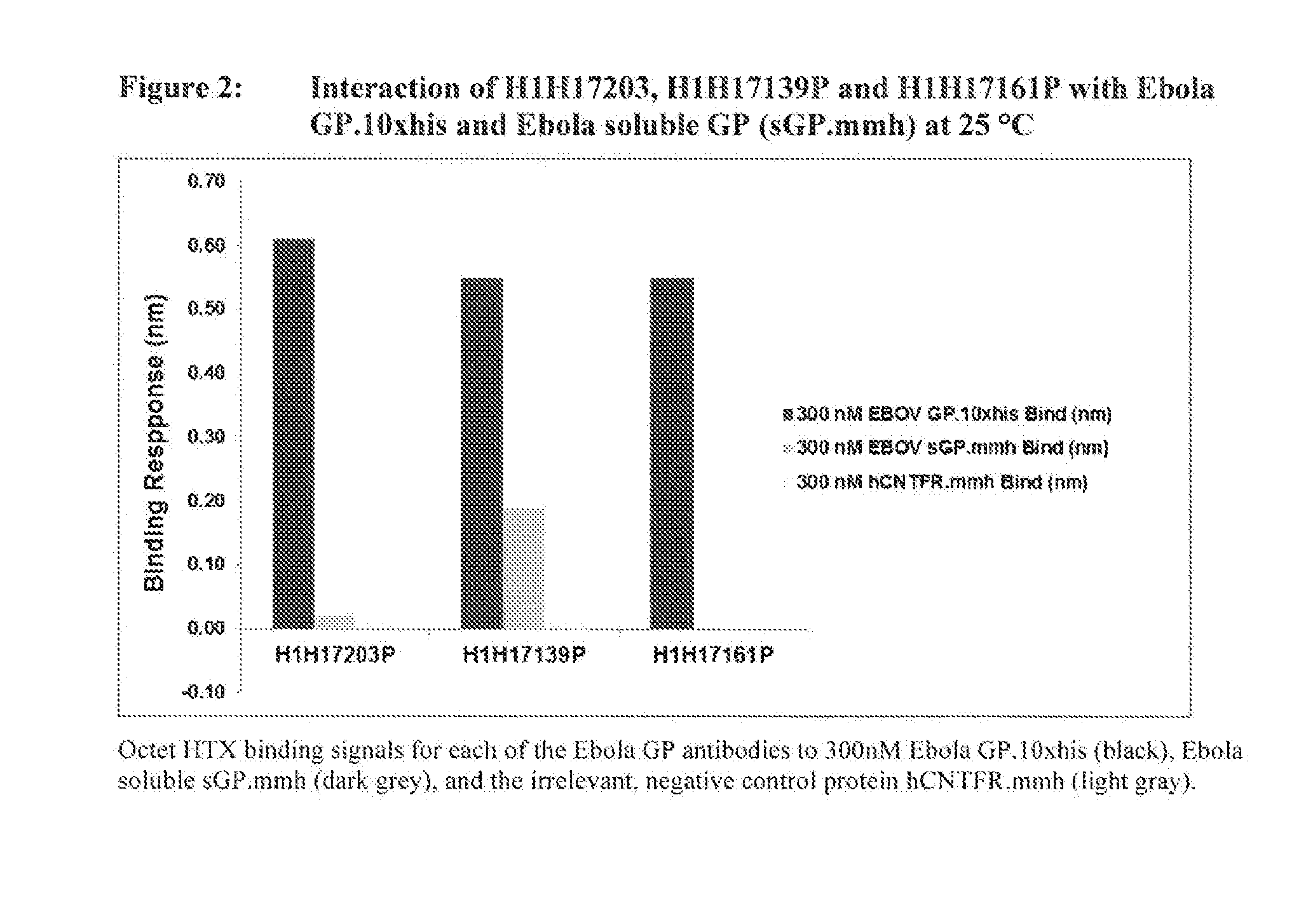

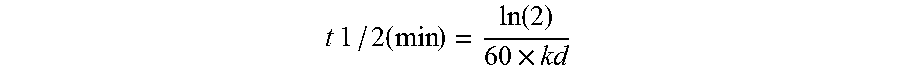

Human Antibodies to Ebola Virus Glycoprotein

ActiveUS20160215040A1Inhibiting and neutralizing activityAvoid enteringImmunoglobulins against virusesAntiviralsViral glycoproteinAntigen Binding Fragment

The present invention provides monoclonal antibodies, or antigen-binding fragments thereof, that bind to Ebola virus glycoproteins, pharmaceutical compositions comprising the antibodies and methods of use. The antibodies of the invention are useful for inhibiting or neutralizing Ebola virus activity, thus providing a means of treating or preventing Ebola virus infection in humans. In some embodiments, the invention provides for use of one or more antibodies that bind to the Ebola virus for preventing viral attachment and / or entry into host cells. The antibodies of the invention may be used prophylactically or therapeutically and may be used alone or in combination with one or more other anti-viral agents or vaccines.

Owner:REGENERON PHARM INC

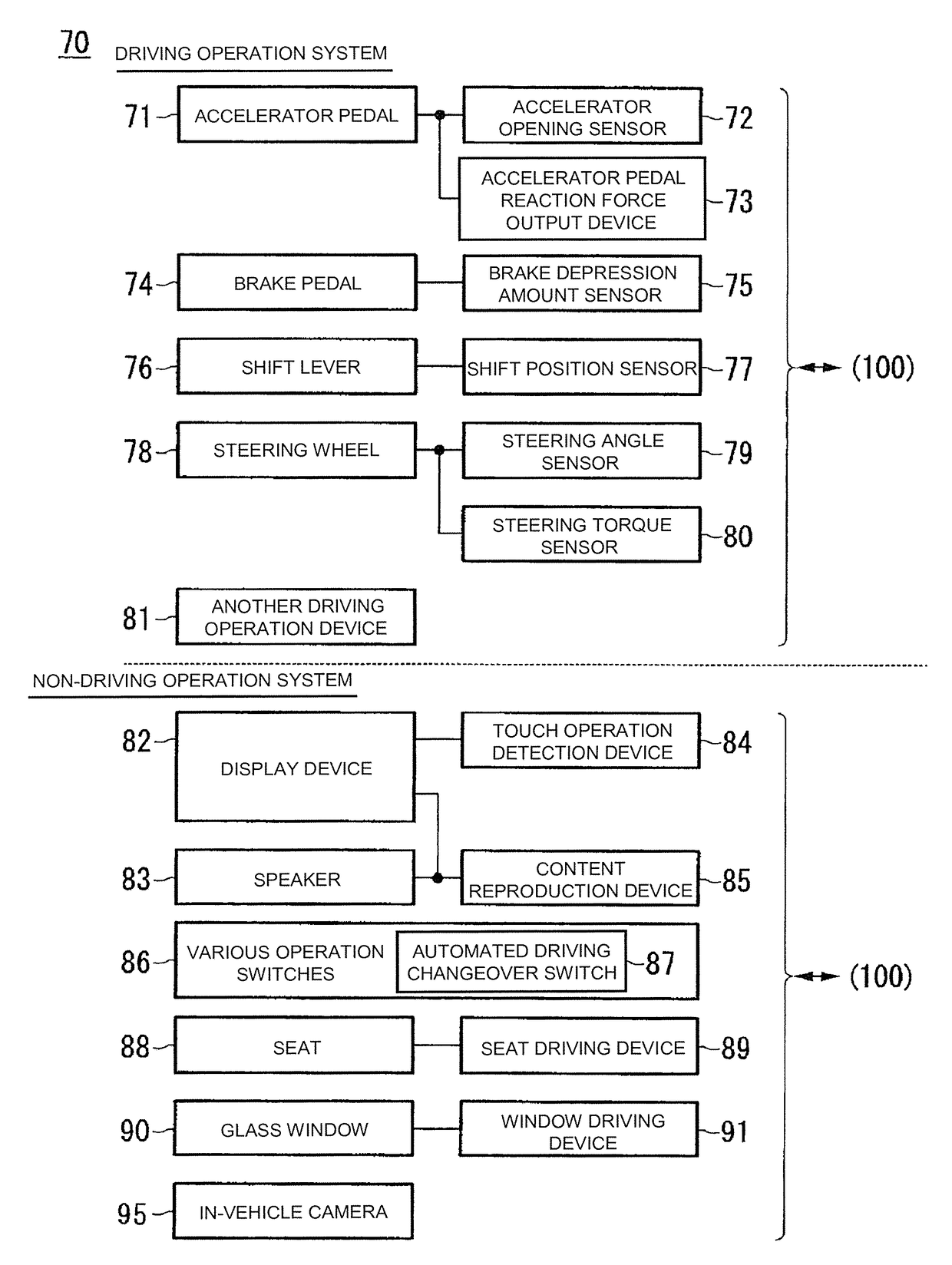

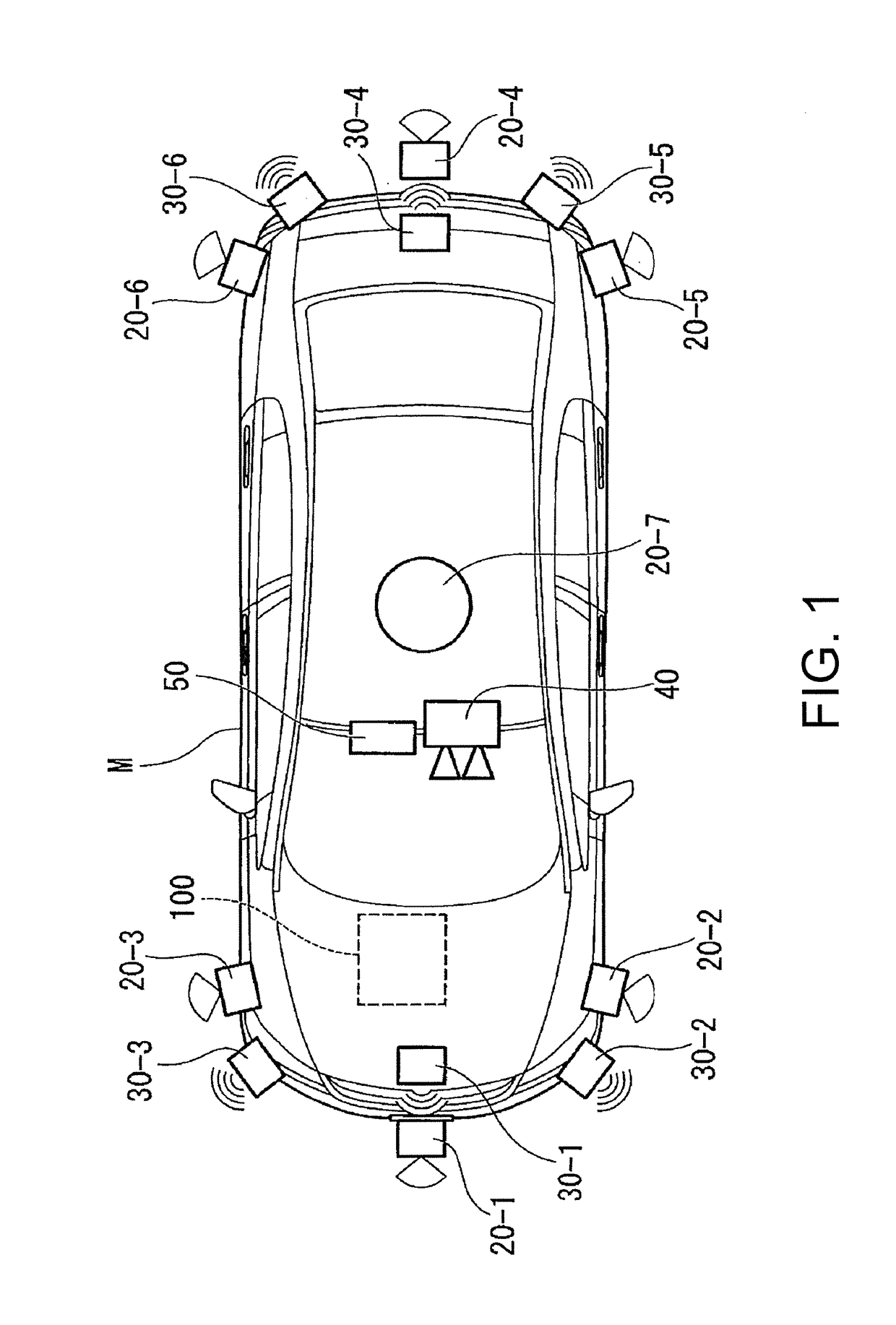

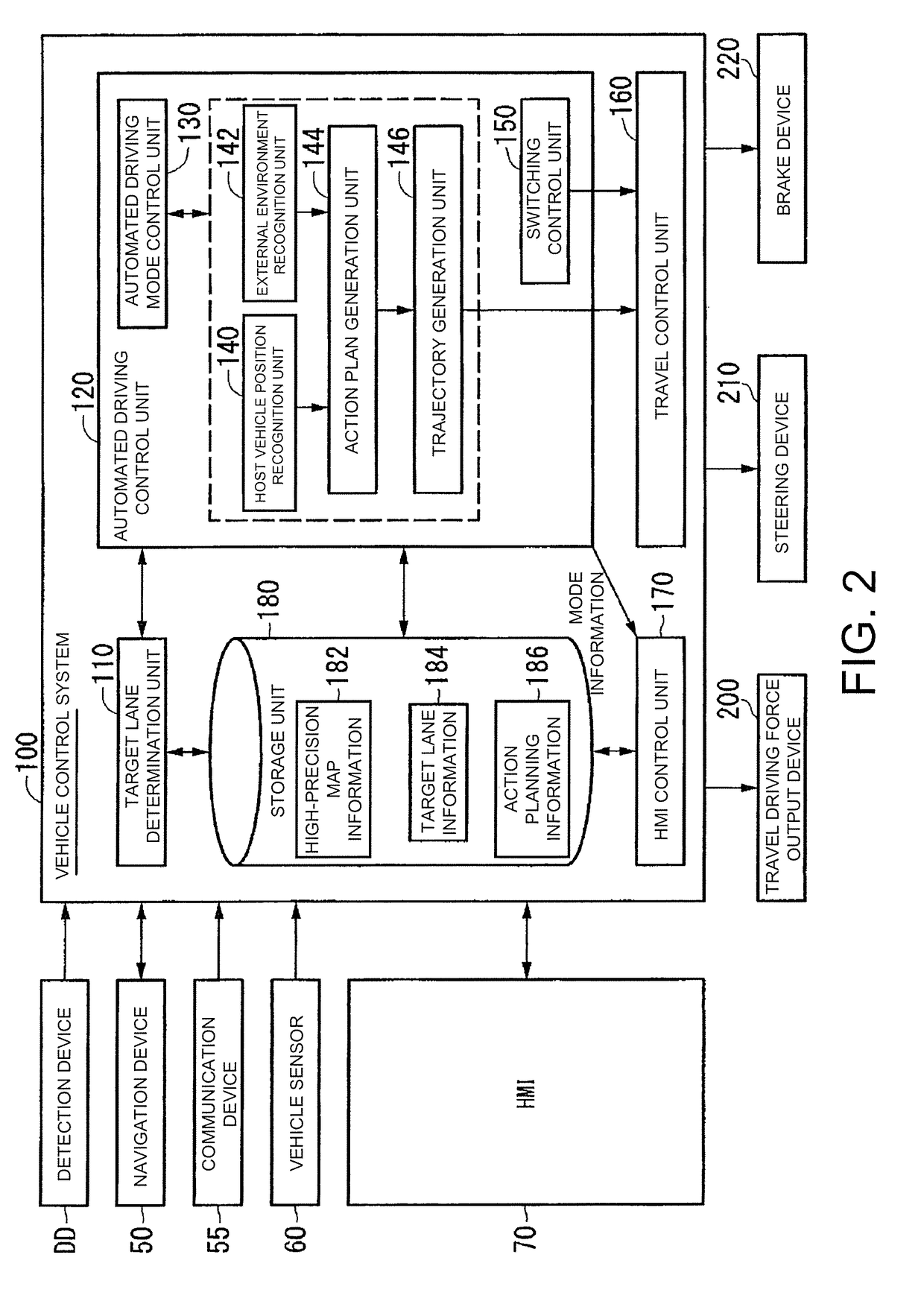

Vehicle control system, vehicle control method, and vehicle control program

ActiveUS20170315556A1Increase likelihoodRaise the possibilityProgramme controlRoad vehicles traffic controlAutomatic controlEngineering

One object is to enable a preparation period for switching between modes in automated driving to be provided for a vehicle occupant. A vehicle control system includes an automated driving control unit that automatically controls at least one of acceleration / deceleration and steering of a host vehicle, the automated driving control unit performing automated driving control in any one of a plurality of modes having different degrees of automated driving, a detection unit that detects a state of an occupant in the host vehicle, an output unit that outputs notification information on the automated driving control, and a notification condition changing unit that changes a notification condition for outputting the notification information according to the state of the occupant detected by the detection unit.

Owner:HONDA MOTOR CO LTD

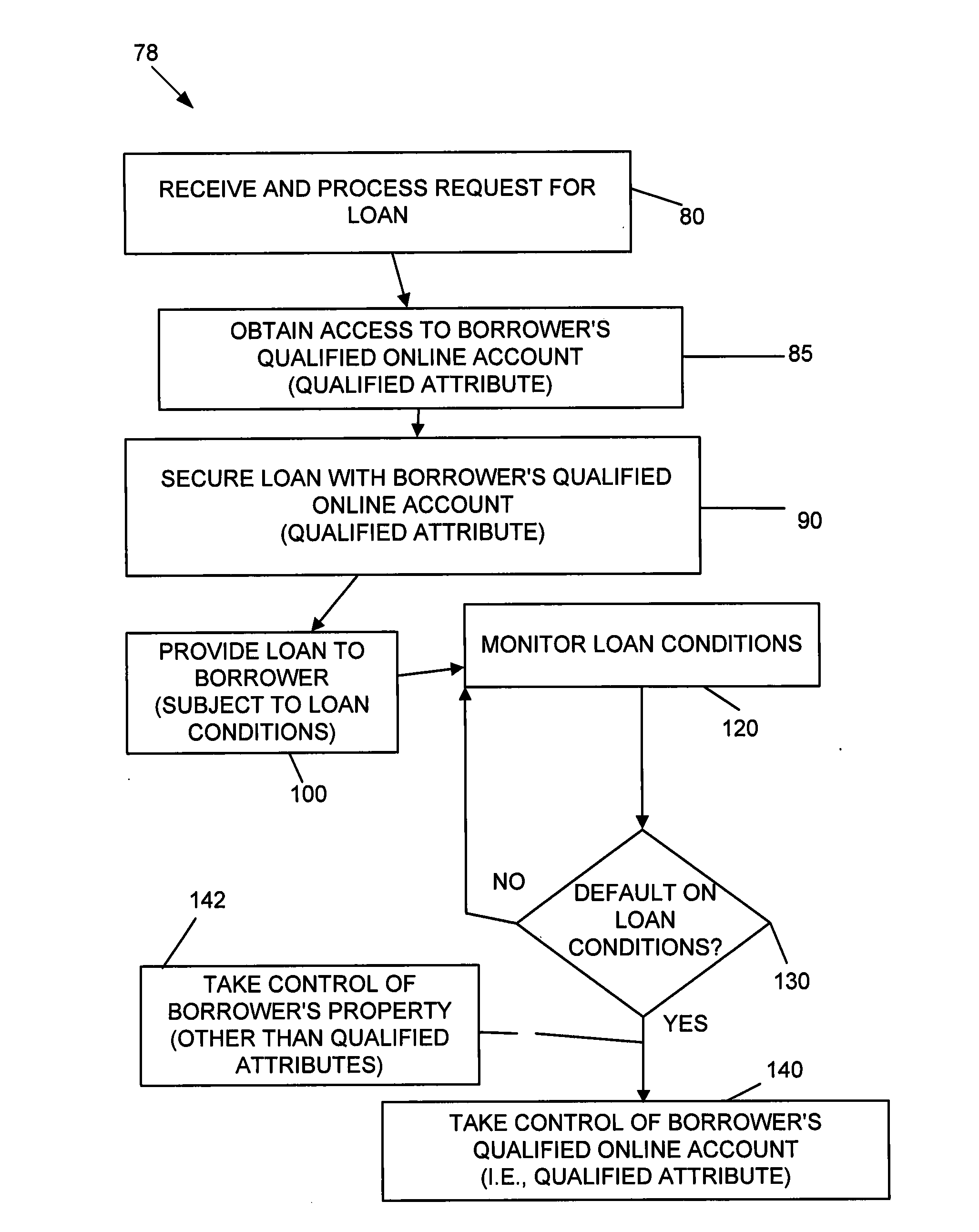

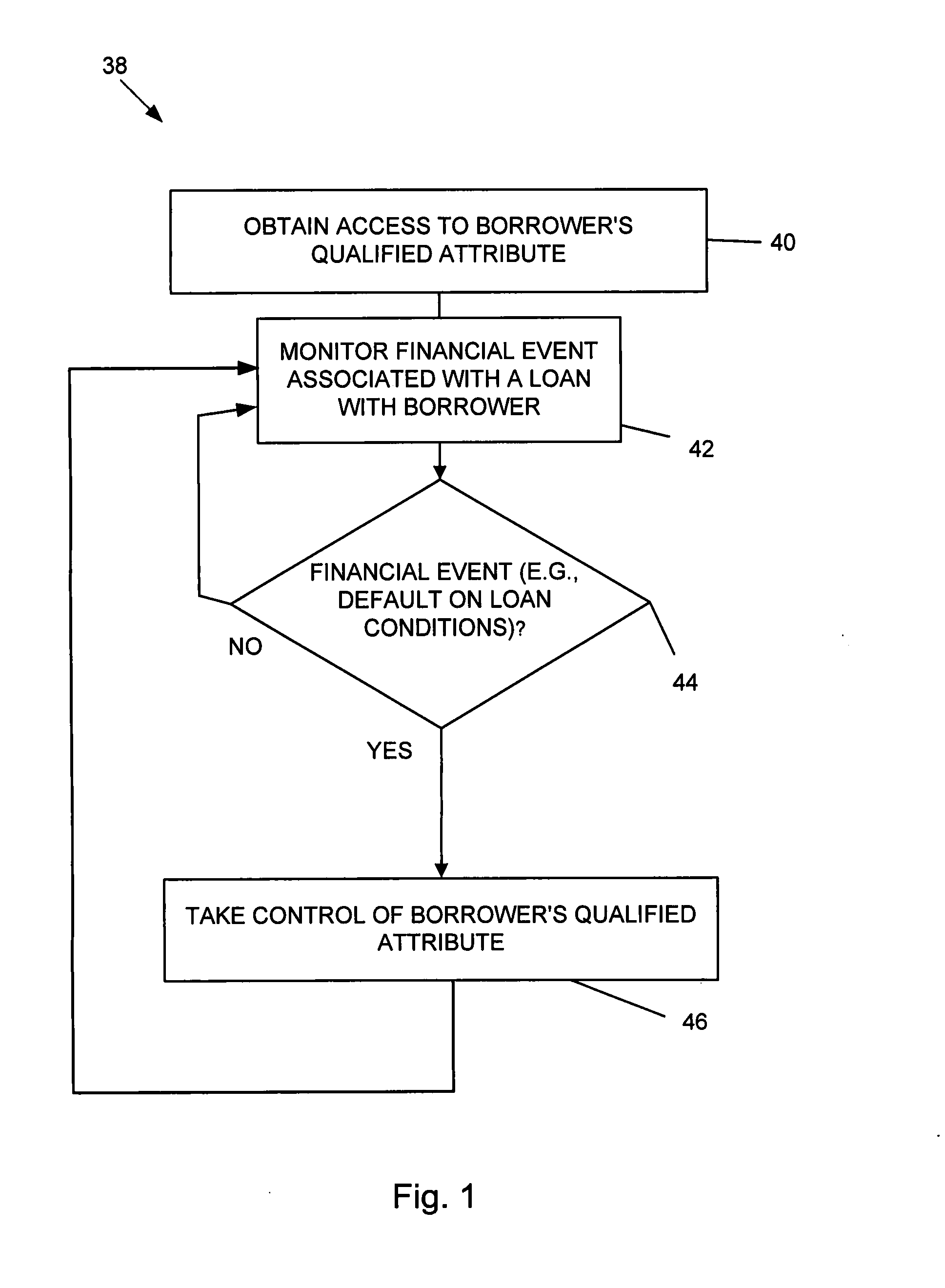

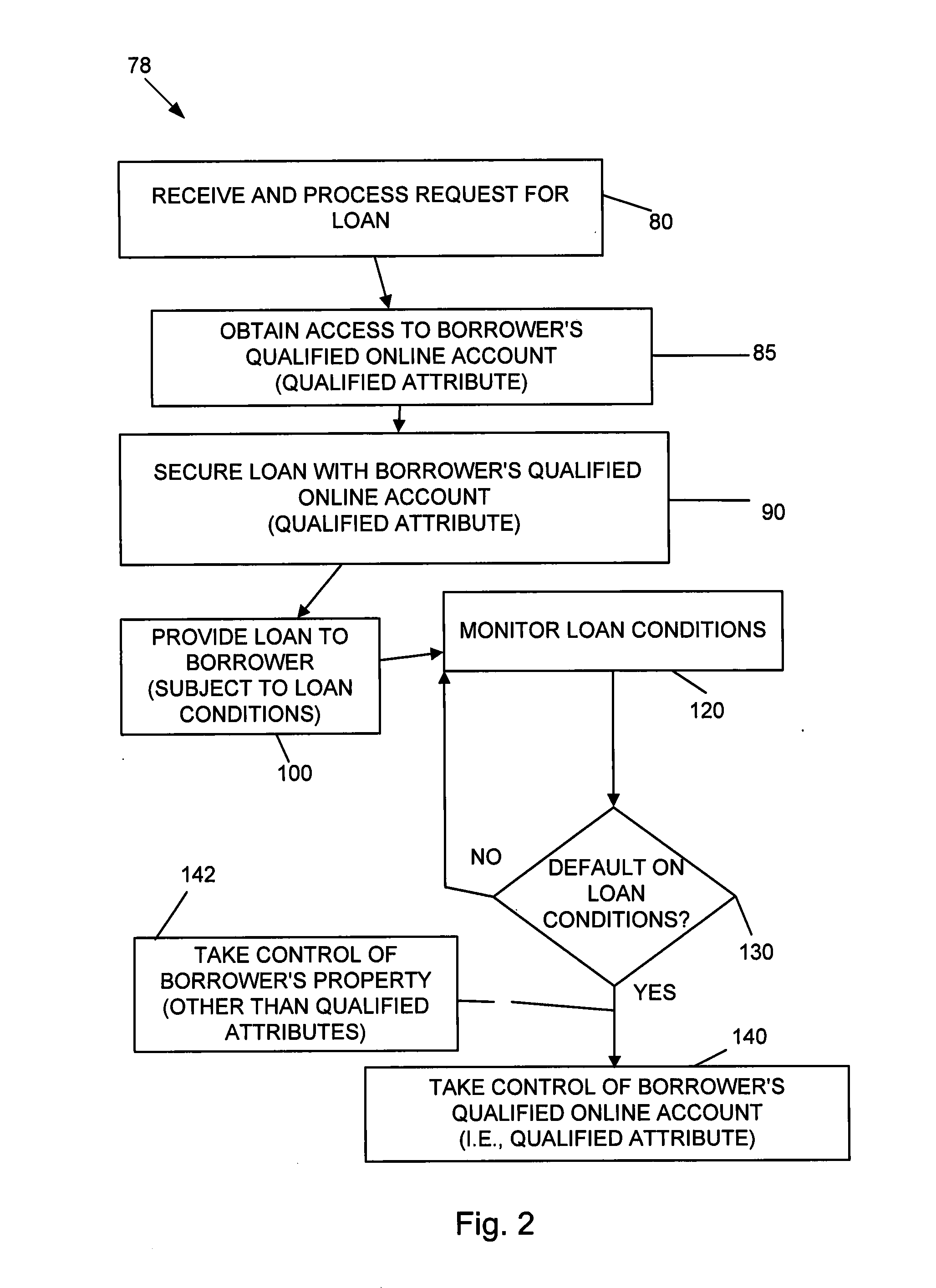

Methods and systems for improving timely loan repayment by controlling online accounts, notifying social contacts, using loan repayment coaches, or employing social graphs

A system and method is disclosed to increase the likelihood of timely repayment of a loan by obtaining access to a qualified attribute of a borrower by a first computer component, monitoring by a second computer component for a financial event associated with the loan to the borrower, and taking control of the qualified attribute of the borrower by a third computer. Taking control may include notifying social contacts. Securing the loan by taking various security interests are disclosed, as are technical countermeasures against the borrower re-obtaining access or re-taking control. Also providing loans, receiving loan applications, providing loans proceeds, processing payments and underwriting criteria are disclosed. Underwriting employing social contacts for recommendations, loan guarantees, social contact credit scores, public repayment promises, loan repayment coaches, fraud criteria, crowd sourced risk evaluation, social graphs, borrower stability factors derived from social graphs, data associated with online information repositories, and efficacy of notification are disclosed.

Owner:SOCIOGRAMICS

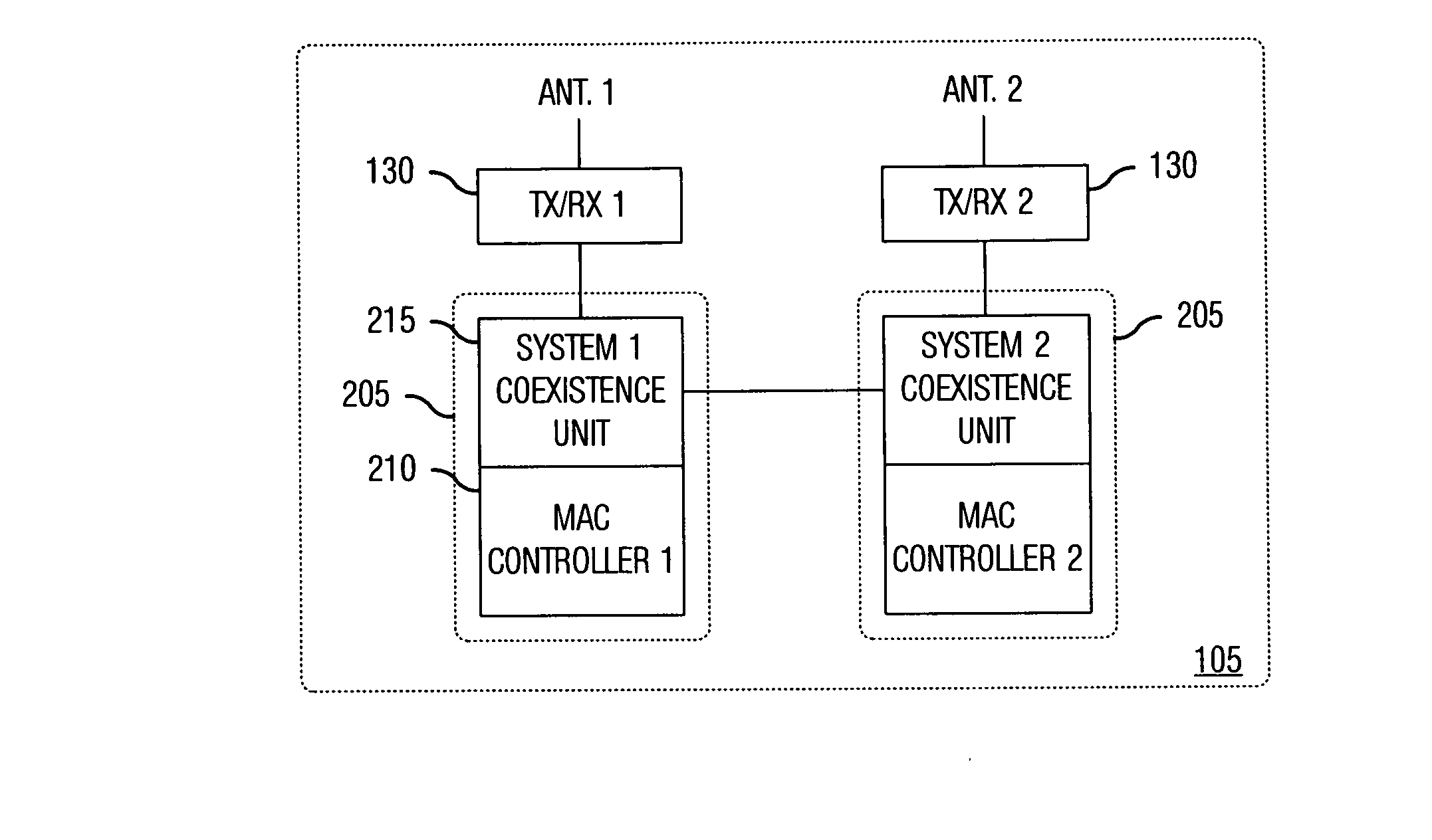

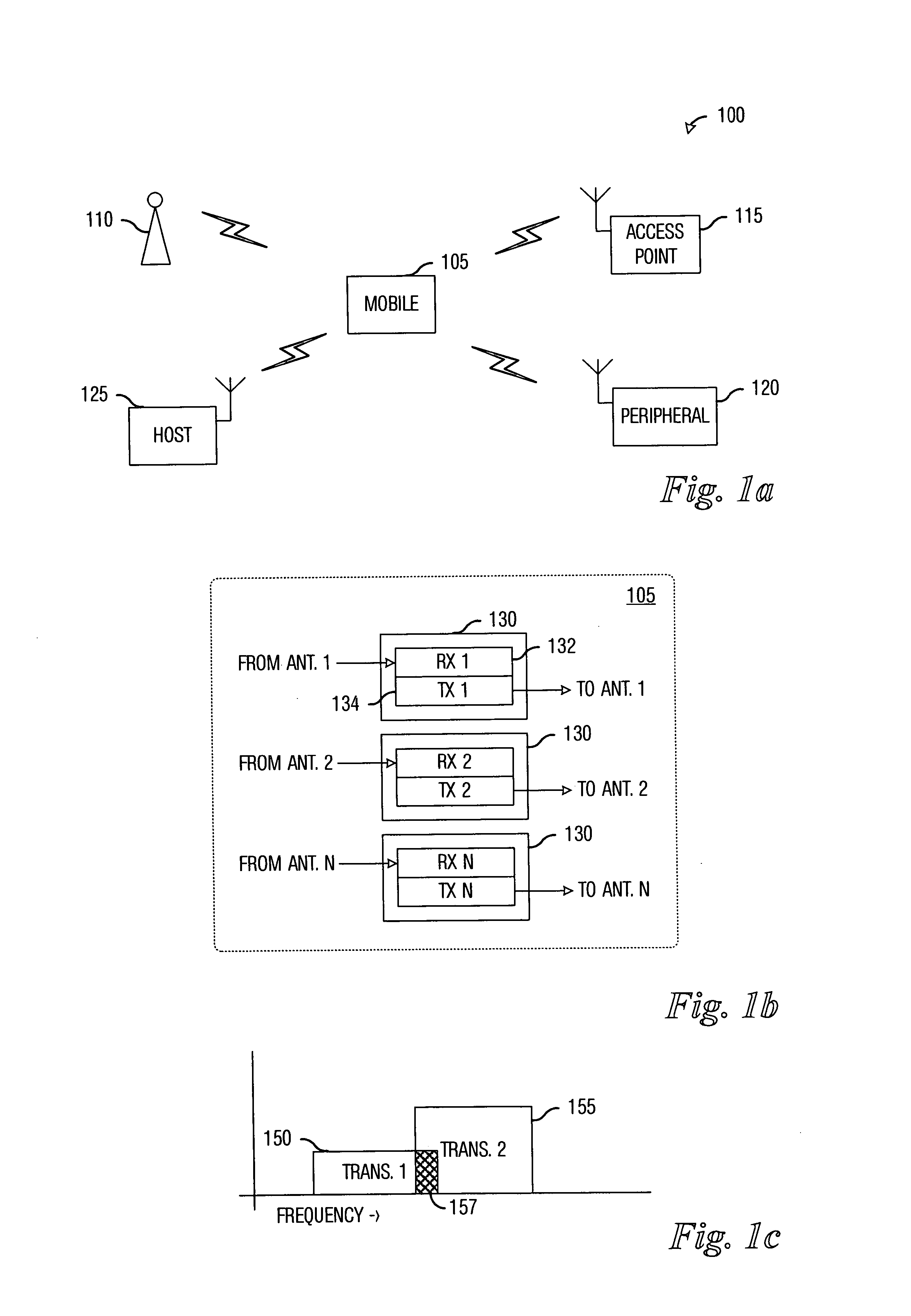

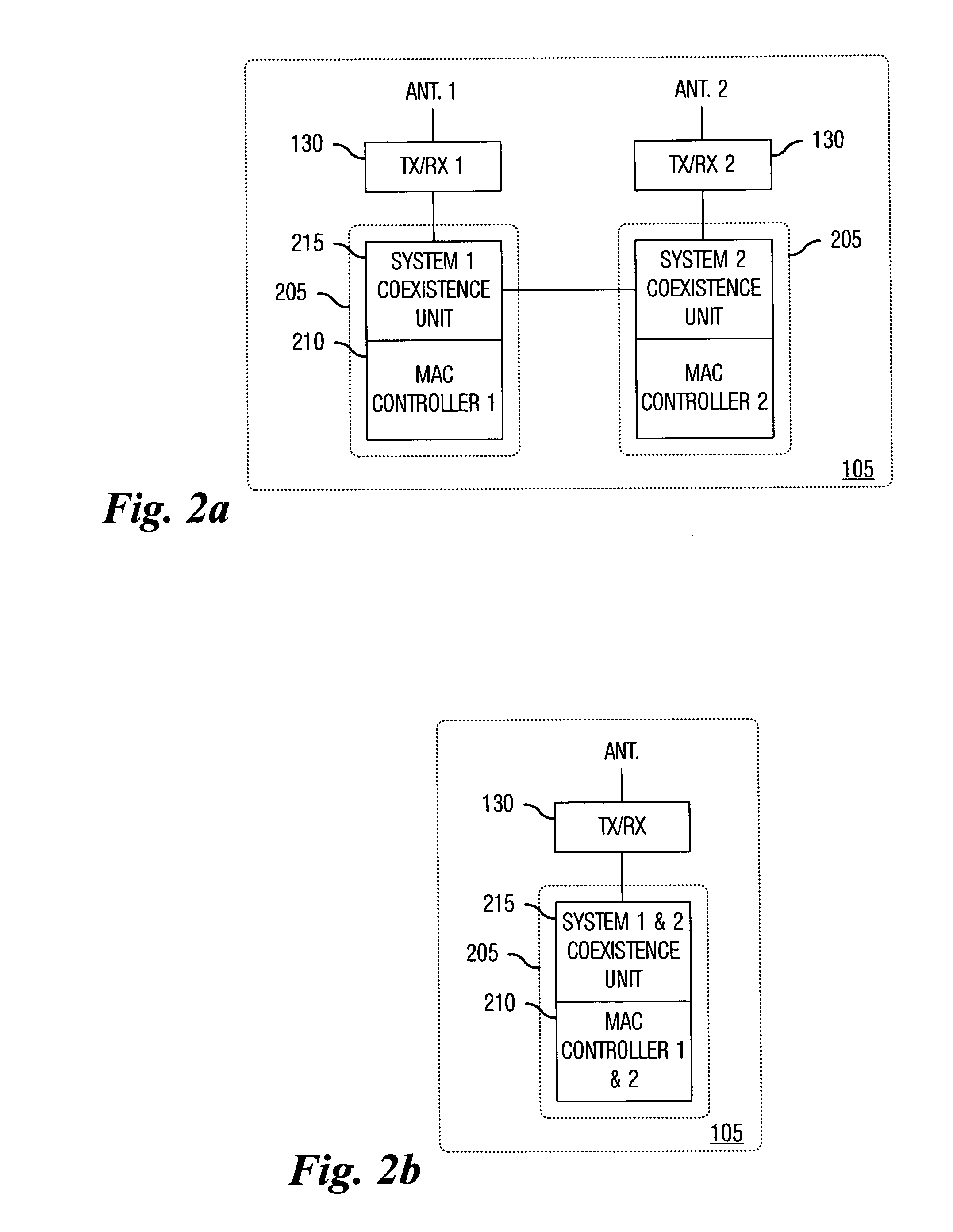

System and method for wireless communication systems coexistence

InactiveUS20070066314A1Reduced compatibilityIncrease likelihoodRadio/inductive link selection arrangementsWireless communicationData transmissionWireless communication systems

Owner:TEXAS INSTR INC

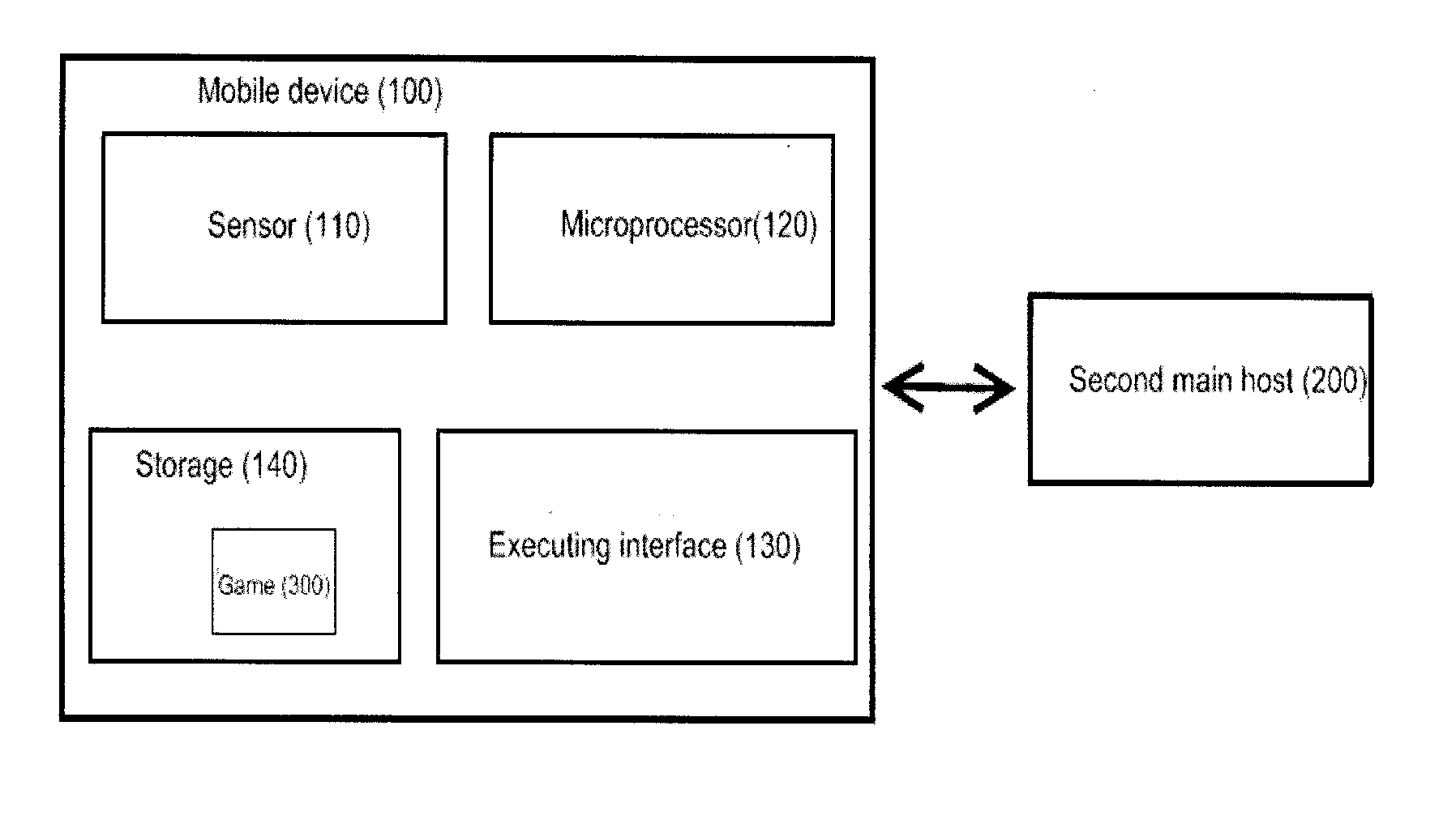

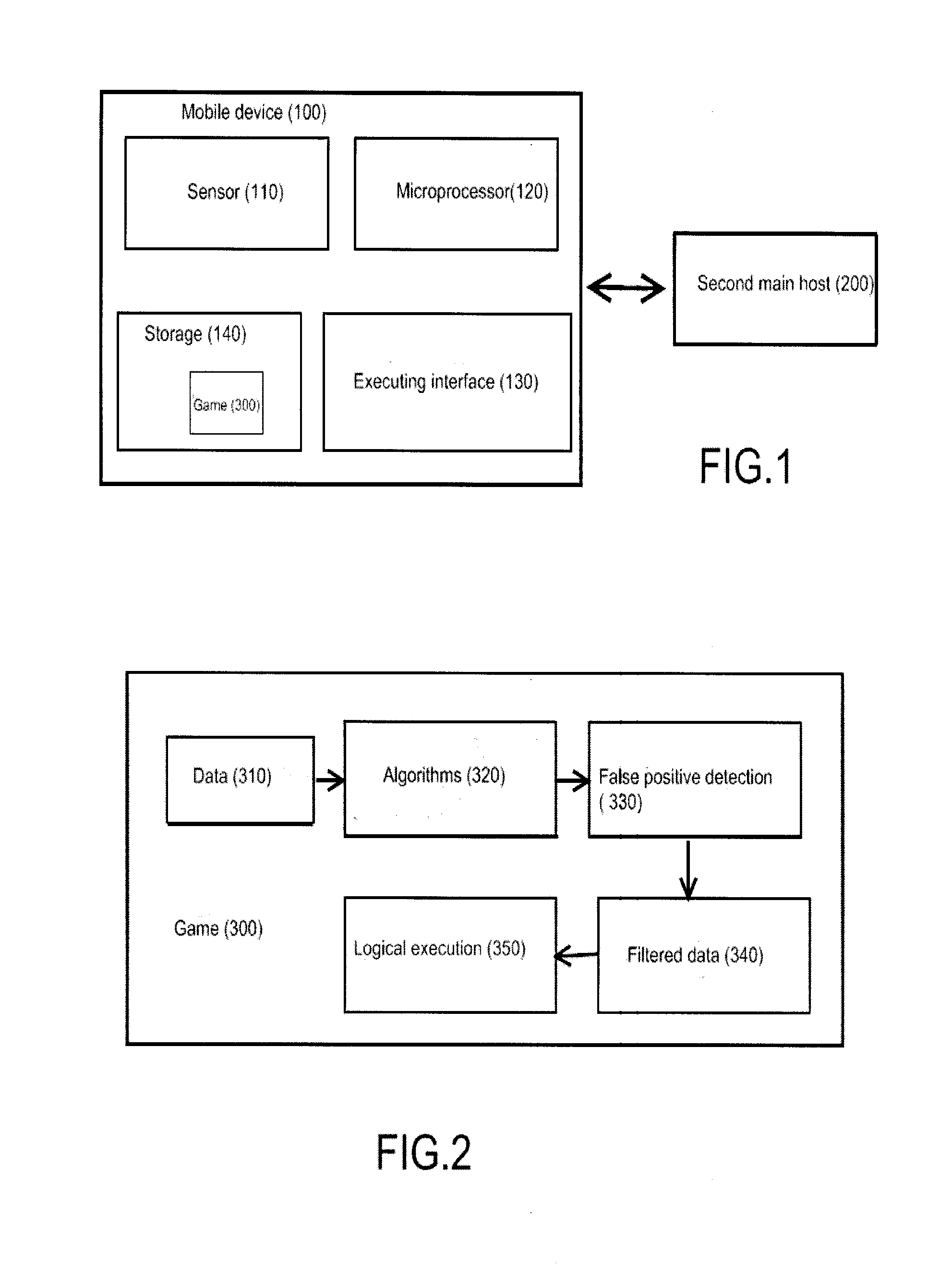

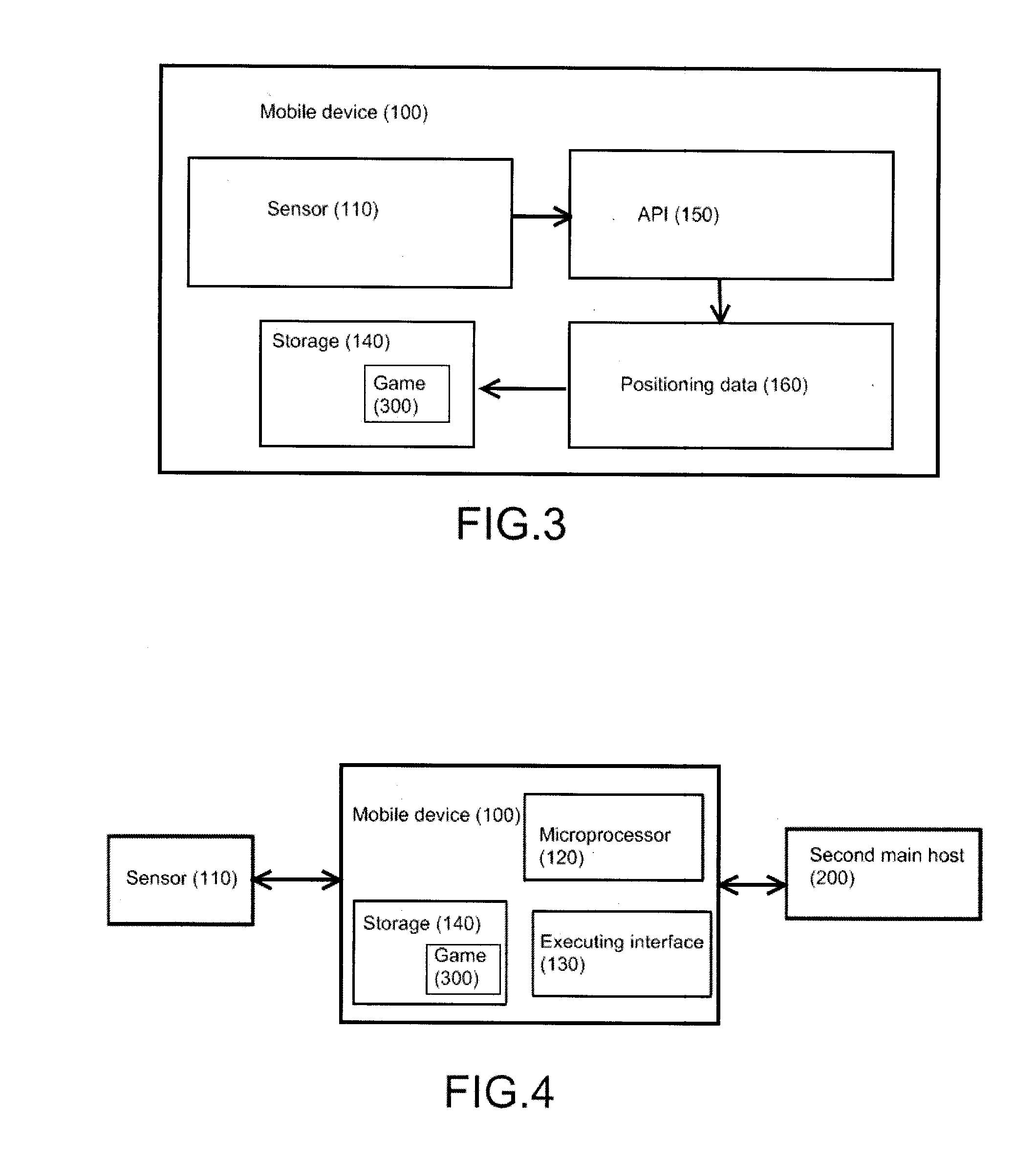

Sensor based human motion detection gaming with false positive detection

InactiveUS20100323794A1Increase likelihoodLess reliableVideo gamesSpecial data processing applicationsSystem usageMobile phone

A sensor based human motion detection gaming with false positive detection uses a single sensor or a combination of sensors to measure the physical motions of the player and then uses this motion as input in an interactive game. The interactive game resides on a mobile host such as a mobile phone. The system uses algorithms on the data gathered by the sensors to determine the current physical activity being performed by the player. Game play progression is then based on the physical activity being performed. The system also filters data to detect cheating patterns that may be used by a player to gain an unfair advantage in a game that uses such a system.

Owner:SU YUI ZHANG

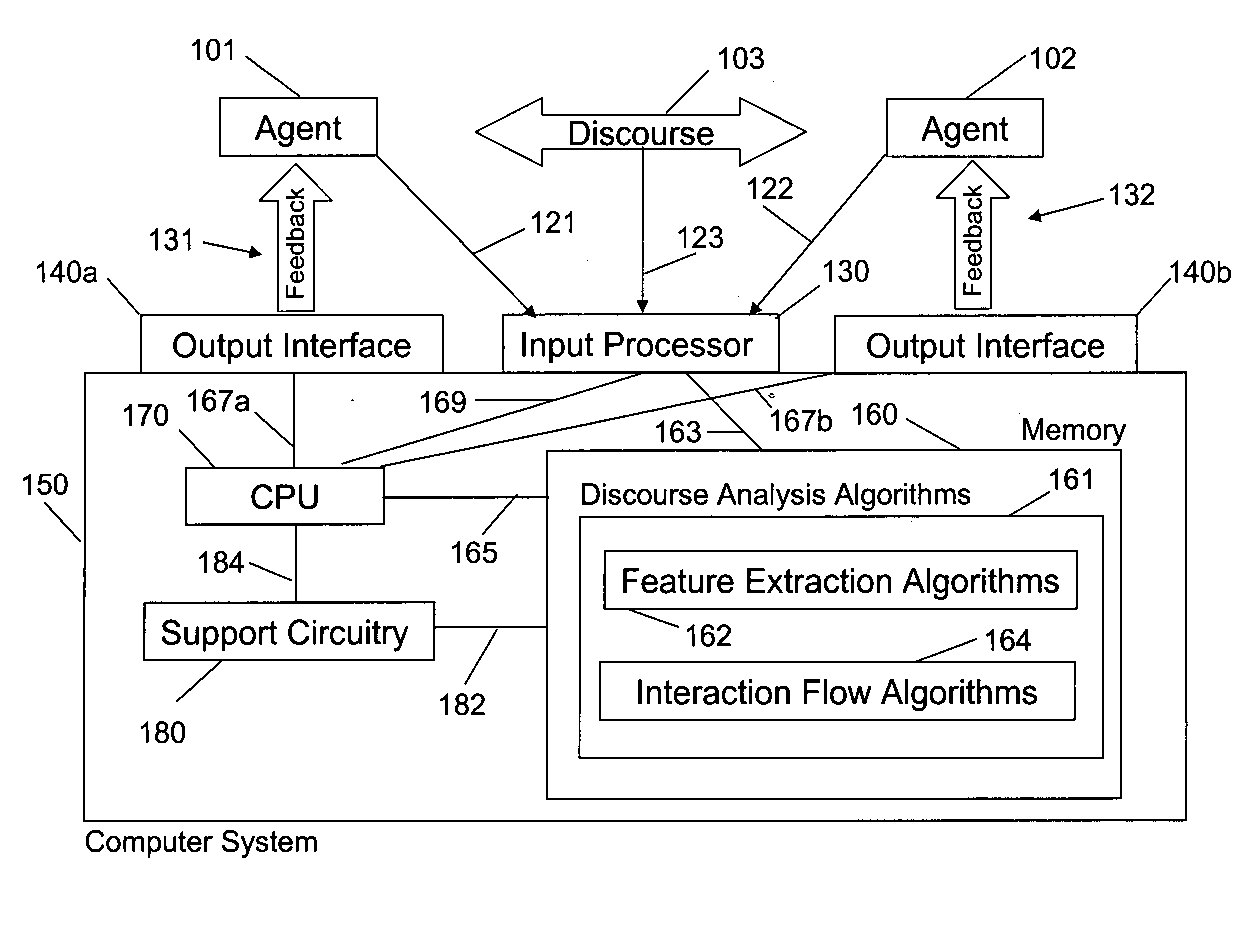

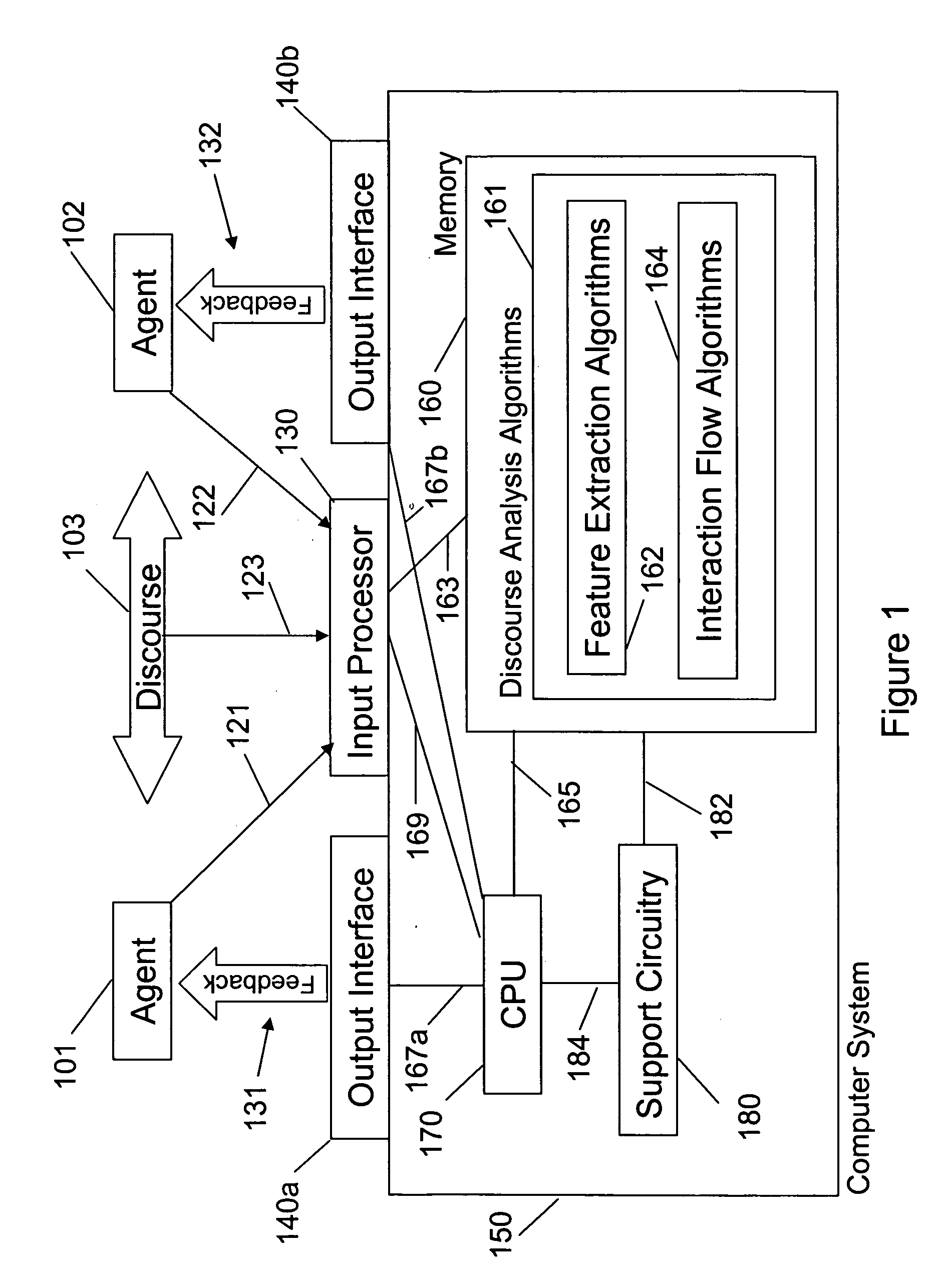

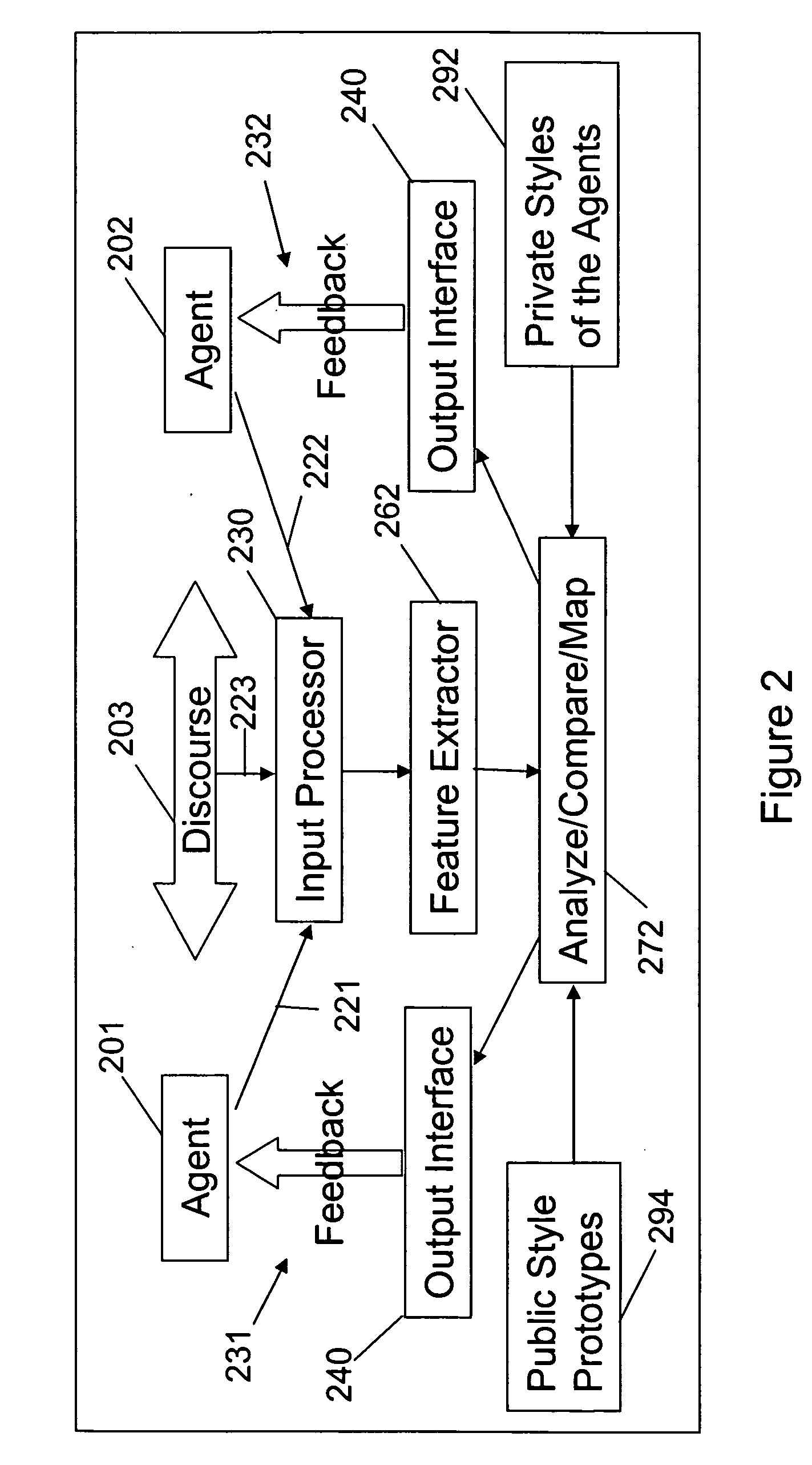

System and method for analyzing and improving a discourse engaged in by a number of interacting agents

InactiveUS20050246165A1Easy to operateIncrease sale closing probabilitySpeech recognitionNatural language processingUtterance

Owner:QUALIA

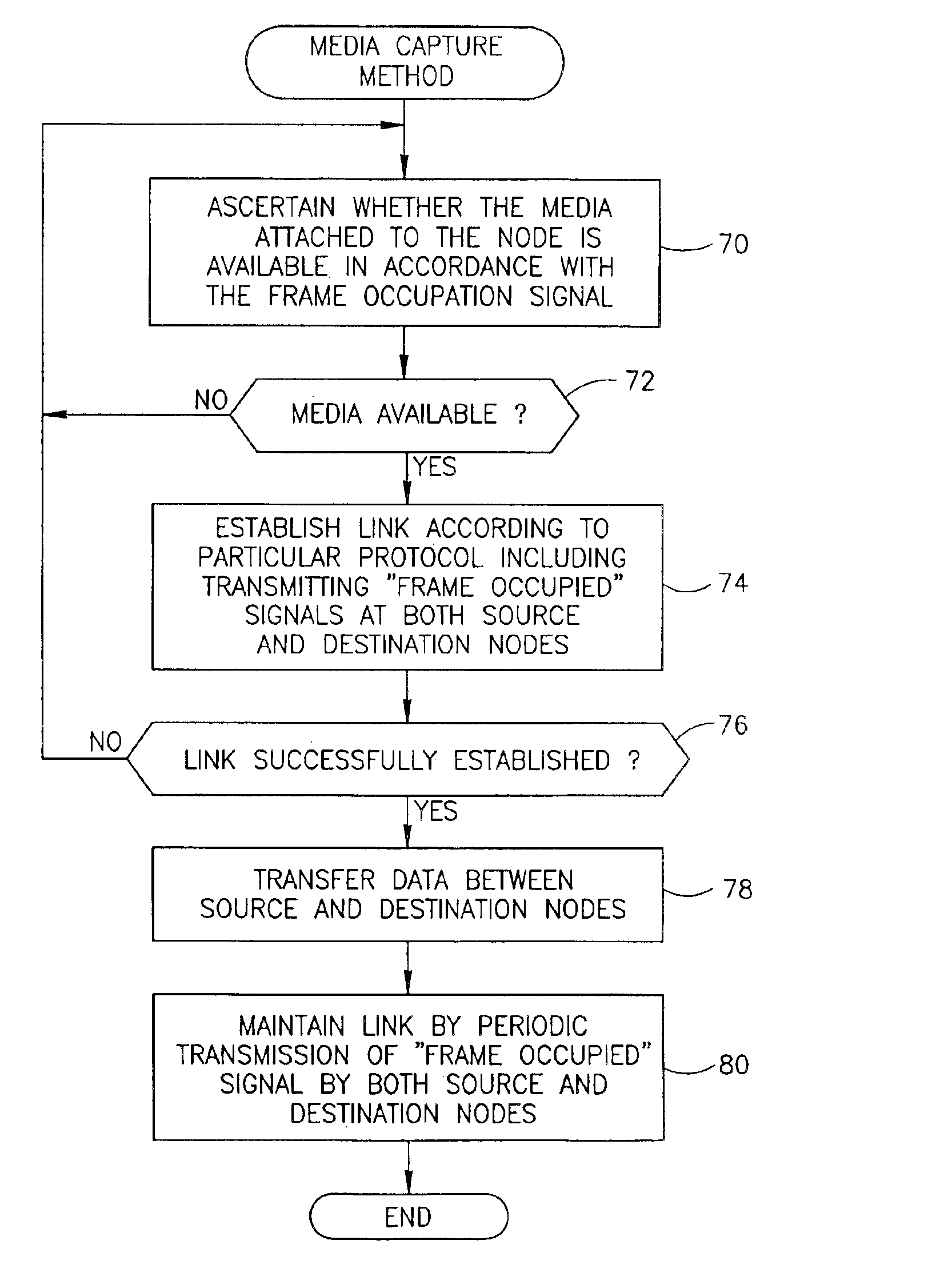

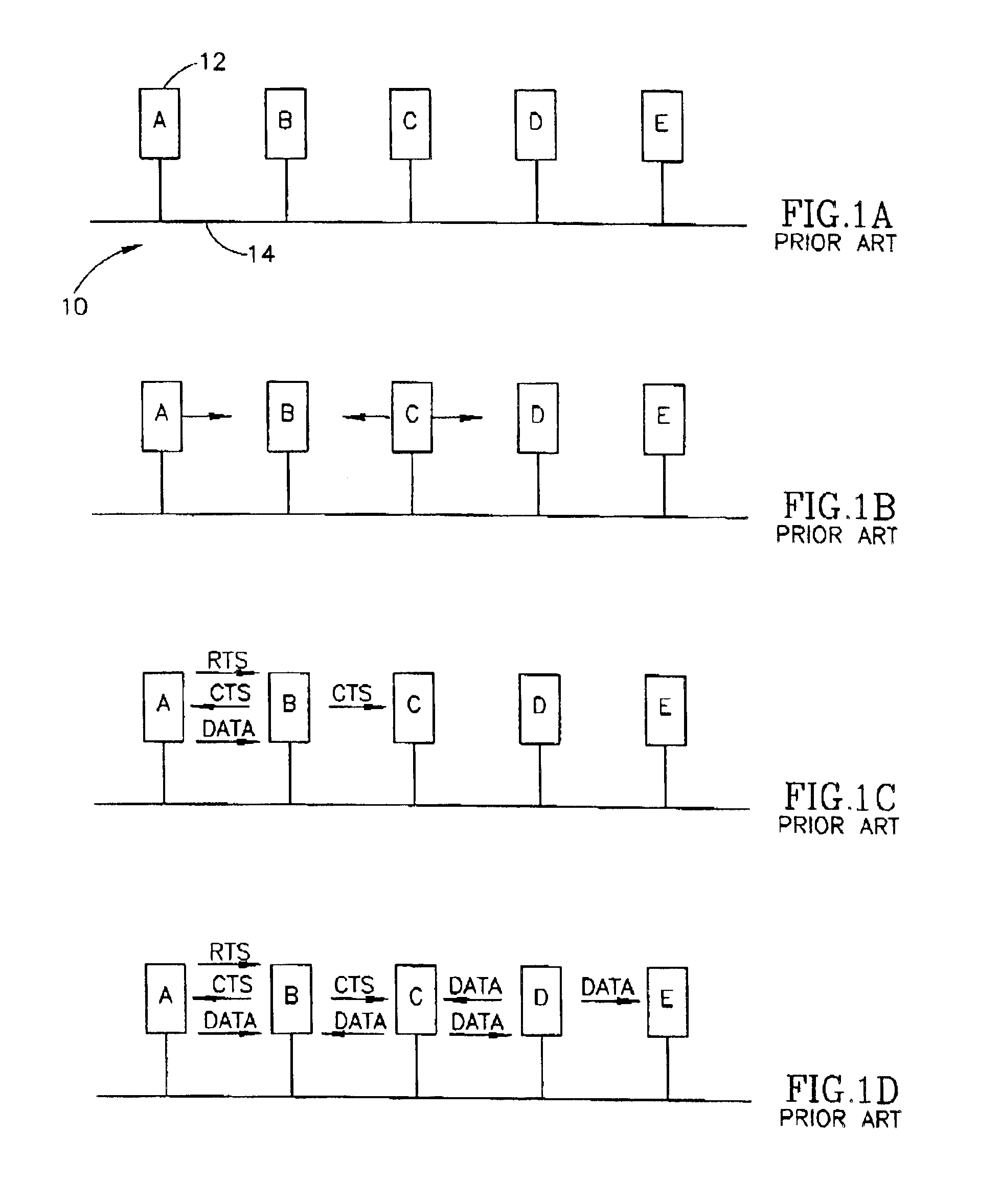

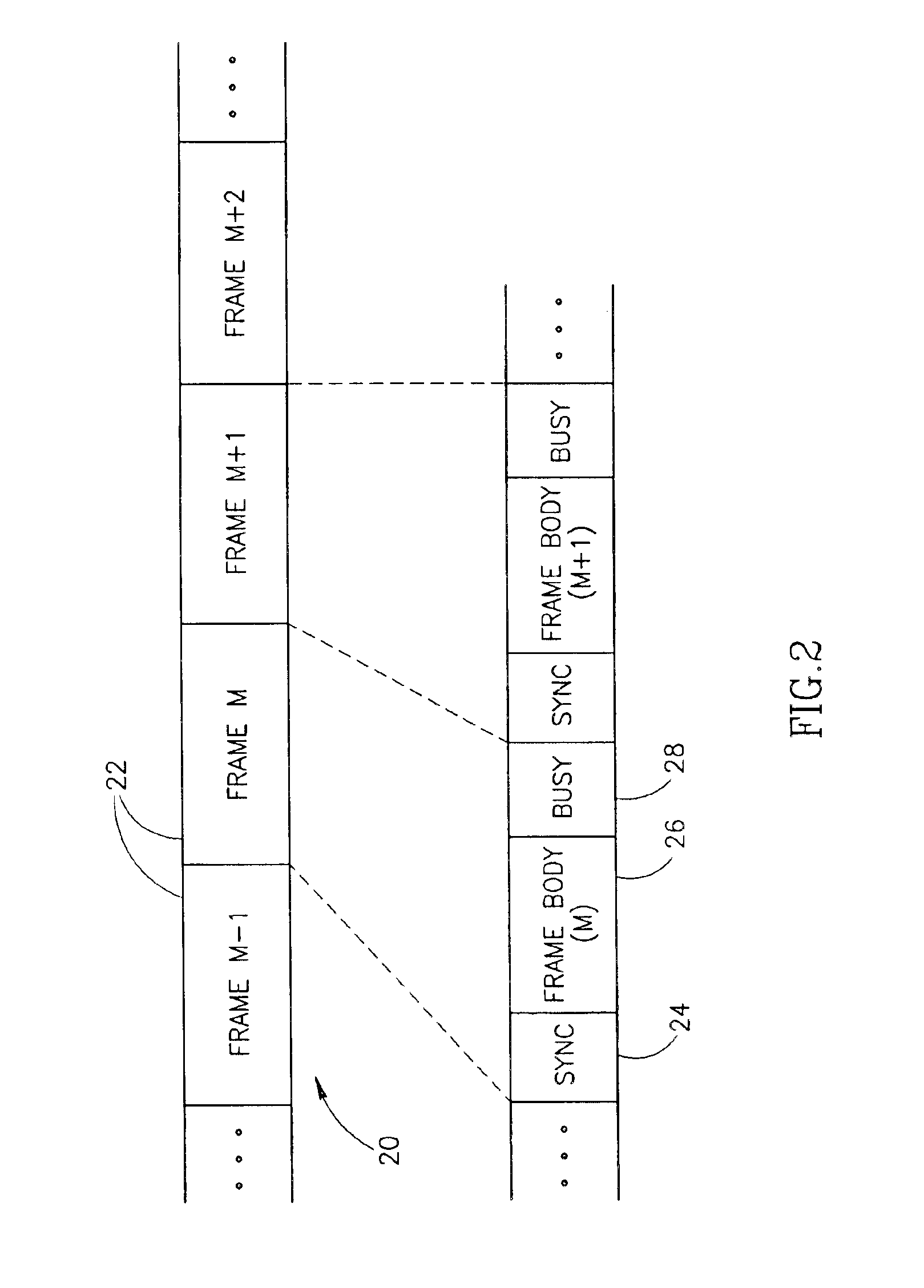

Media access control utilizing synchronization signaling

InactiveUS6888819B1Increase likelihoodImprove the problemSynchronisation arrangementTime-division multiplexMonitor modeCommunications system

A novel media access control (MAC) mechanism utilizing synchronization signaling that enables nodes from different networks having different technologies and protocols to coexistence using the same shared media. The present invention is suitable for use with a wide range of different types of network and technologies and is particularly useful in providing coexistence capabilities to powerline based data communication systems. Specific time slots are assigned for the transmission of a frame occupation signal to indicate to all nodes that the channel is occupied. A synchronization signal is randomly transmitted during a preassigned time slot within the frame to provide accurate timing for the frame occupation signal. During times that a node does not transmit the synchronization signal, it listens to the channel. A timing signal is derived from the synchronization signals received from other nodes during this quiet period wherein the node is in a listening mode. The node then adjusts its internal clock in accordance with the derived timing signal.

Owner:ITRAN COMM

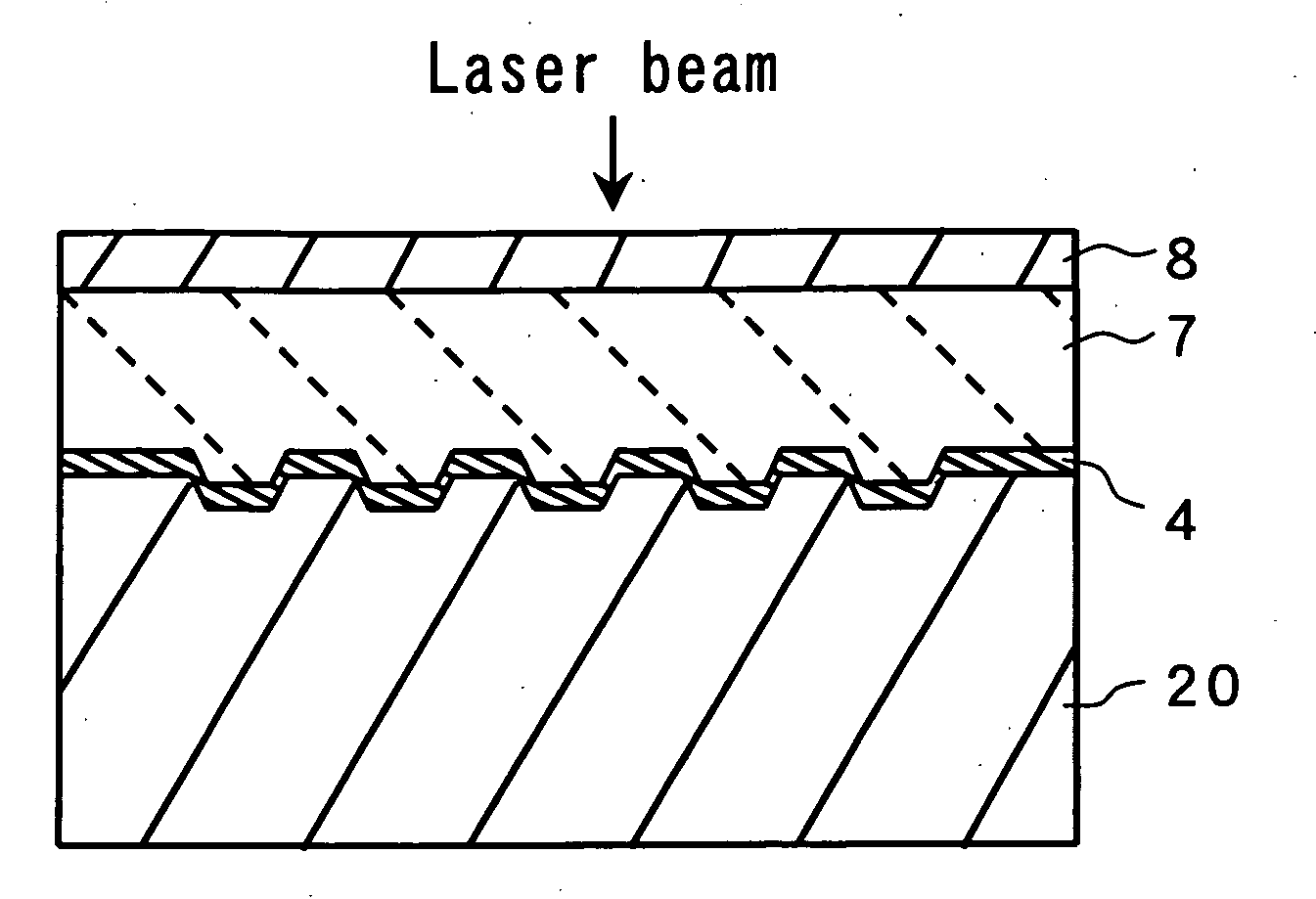

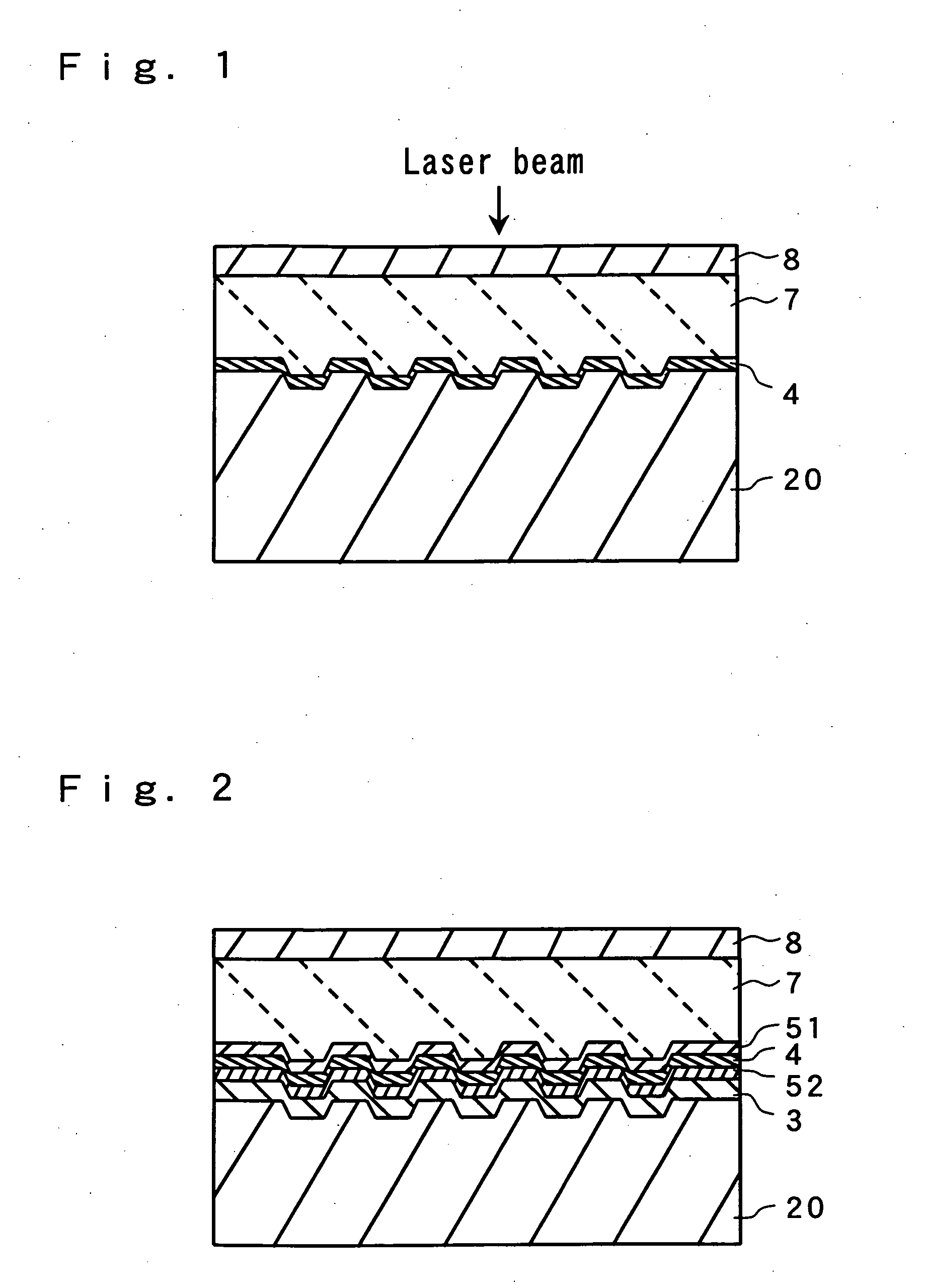

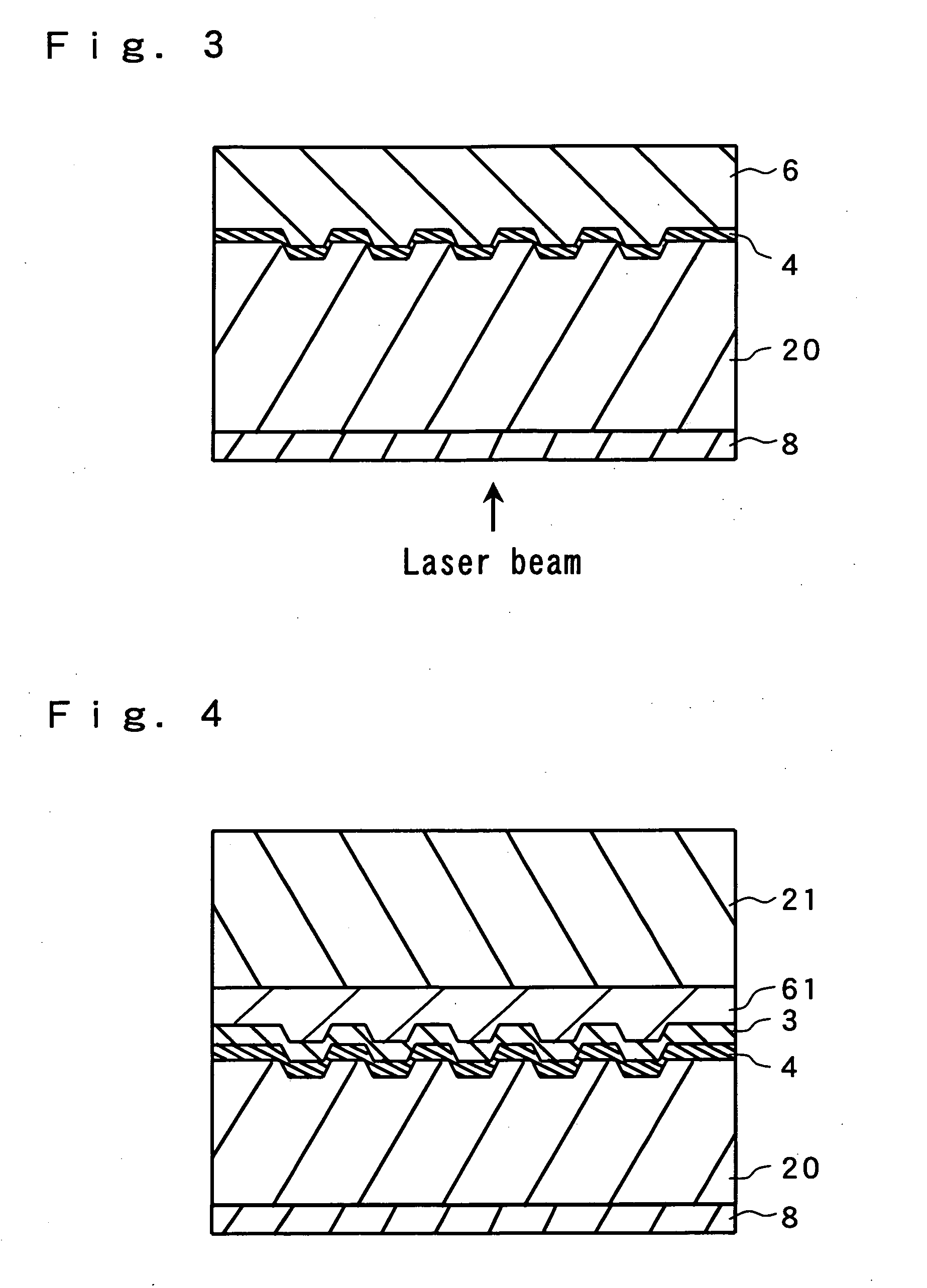

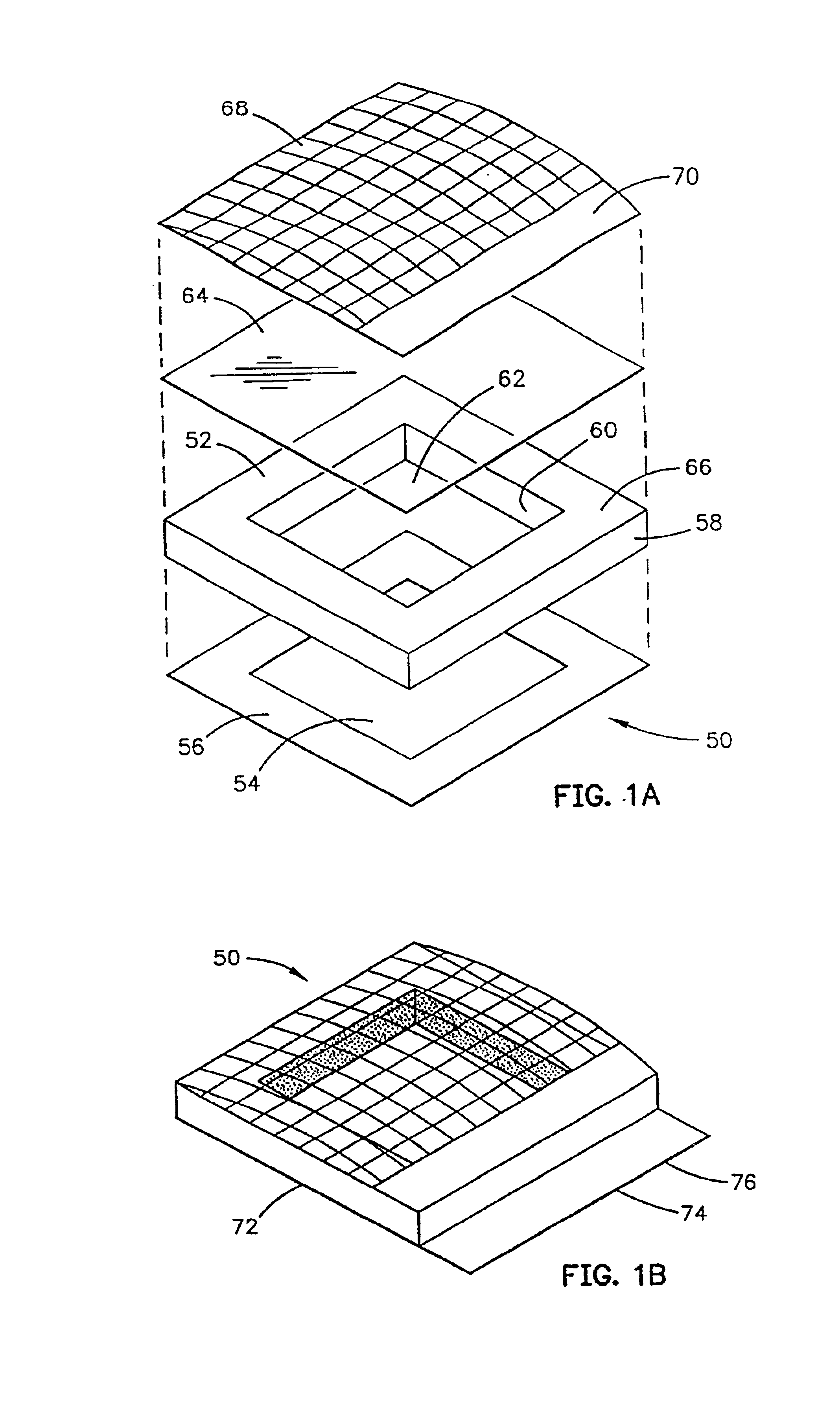

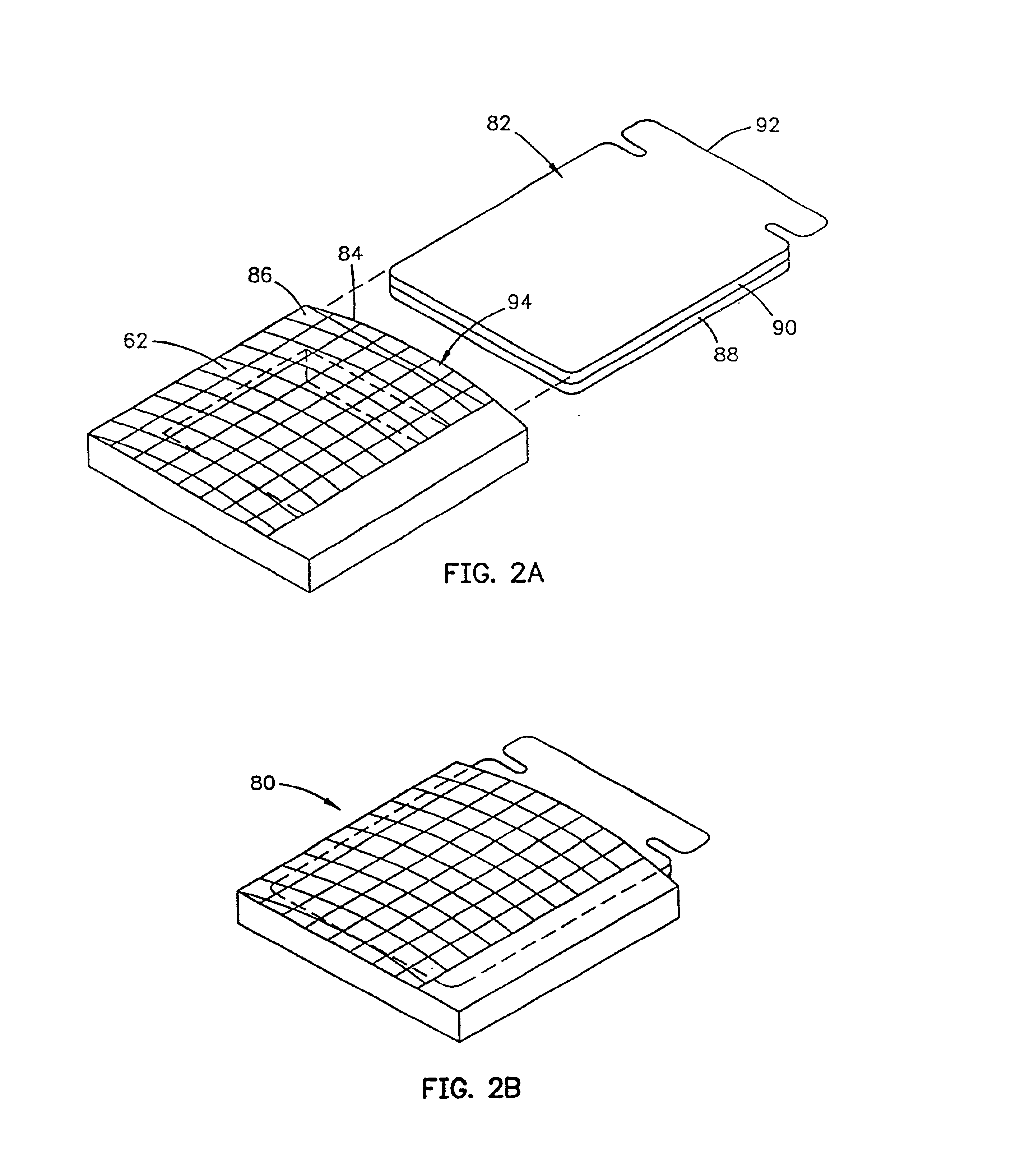

Hard coat agent composition and optical information medium using the same

InactiveUS20050158504A1Reduce coefficient of frictionImprove scratch resistanceLayered productsRecord information storageReflective layerRecording layer

The present invention provides a hard coat agent composition that is useful for forming a hard coat layer with excellent anti-staining properties and lubricity, as well as superior scratch resistance and abrasion resistance, on the surfaces of various articles. The present invention also provides an optical information medium using the above hard coat agent composition. A hard coat agent composition comprising a fluorine-containing block copolymer (A1), a fluorine-containing polyether compound (A2) comprising an active energy ray-reactive group, and an active energy ray-curable compound (B). An optical information medium comprising a film element composed of one or more layers including at least a recording layer (4) or a reflective layer, on a supporting substrate (20), wherein at least one of the supporting substrate (20)-side surface and the film element-side surface is formed of a hard coat layer (8) comprising a cured product of the hard coat agent composition.

Owner:TDK CORPARATION

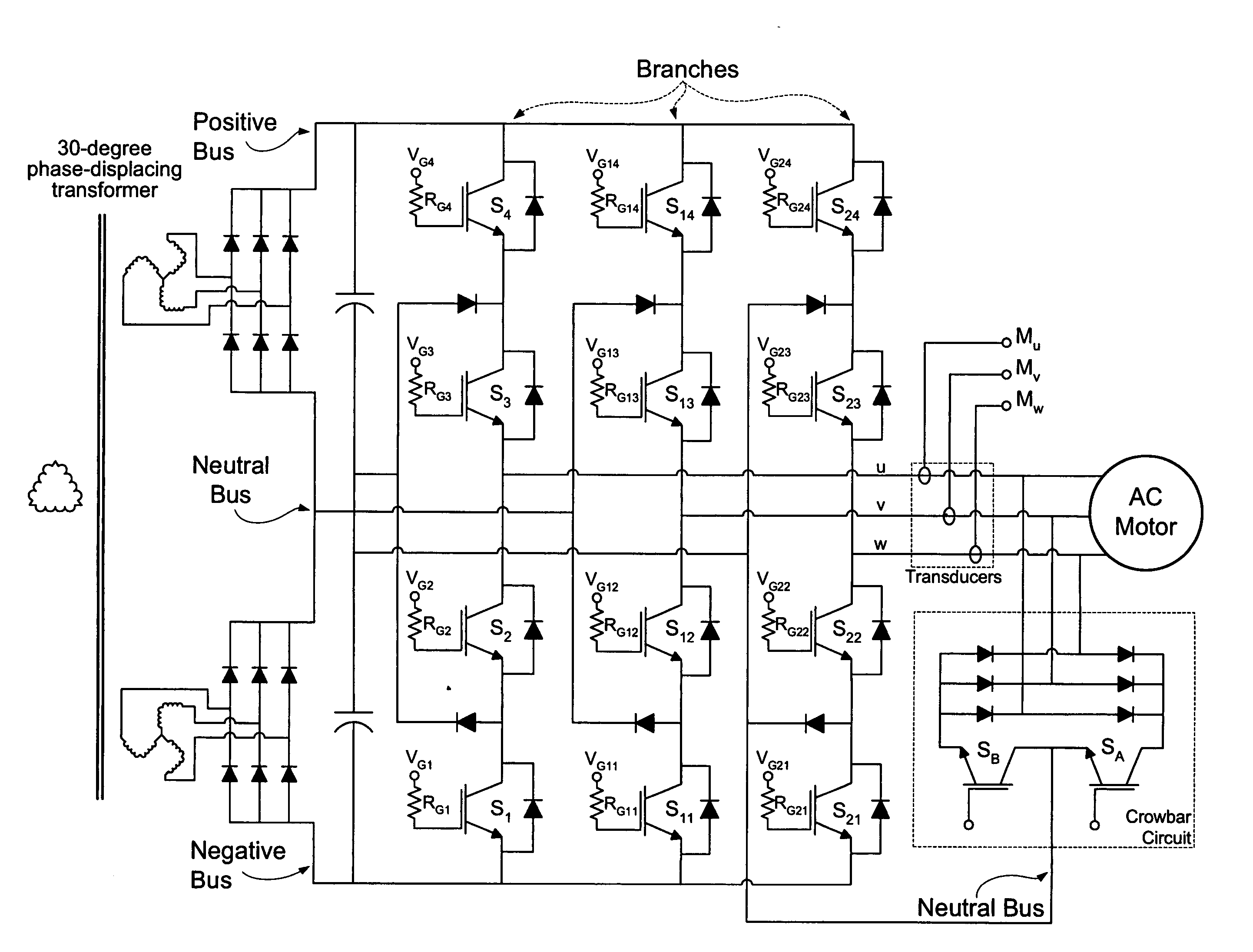

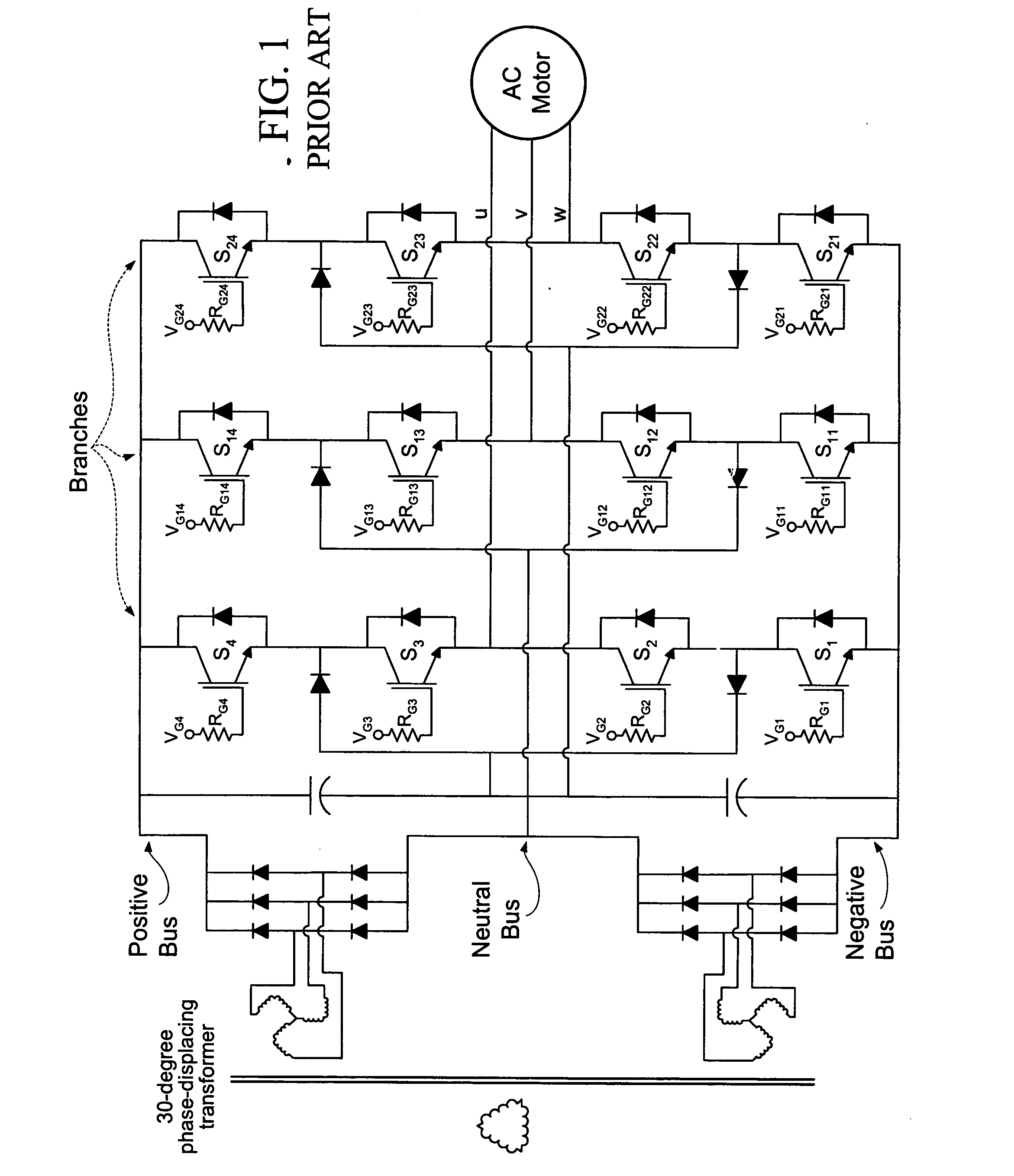

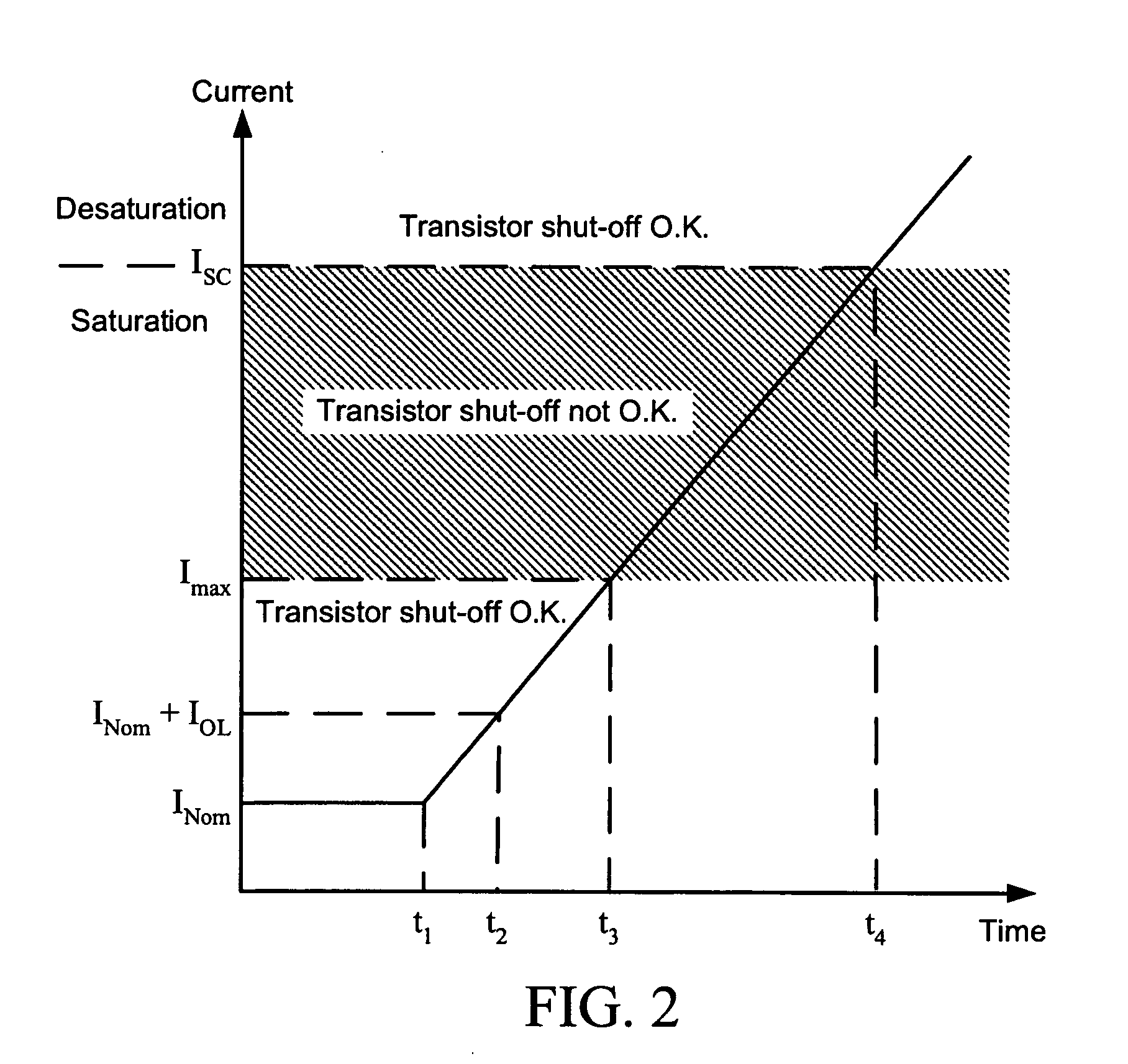

Inverter bridge controller implementing short-circuit protection scheme

ActiveUS20050281065A1Statistical likelihood is improvedImprove survivabilityConversion with intermediate conversion to dcDc-dc conversionThree-phaseShort circuit protection

A fault handling system for short circuit recovery in three-phase multiple-level inverter bridges, used to drive inductive loads, which waits for either desaturation of switches or expiration of a delay period based upon an amount of time before saturated switches are damaged before commanding off switches that are saturated, and which artificially creates a dead-short across the three-phase output to force switches conducting a fault current to desaturate. By delaying the switching-off of the inverter bridge during a fault, waiting for desaturation to occur, the statistical likelihood of switch survival is improved.

Owner:EATON INTELLIGENT POWER LTD +1

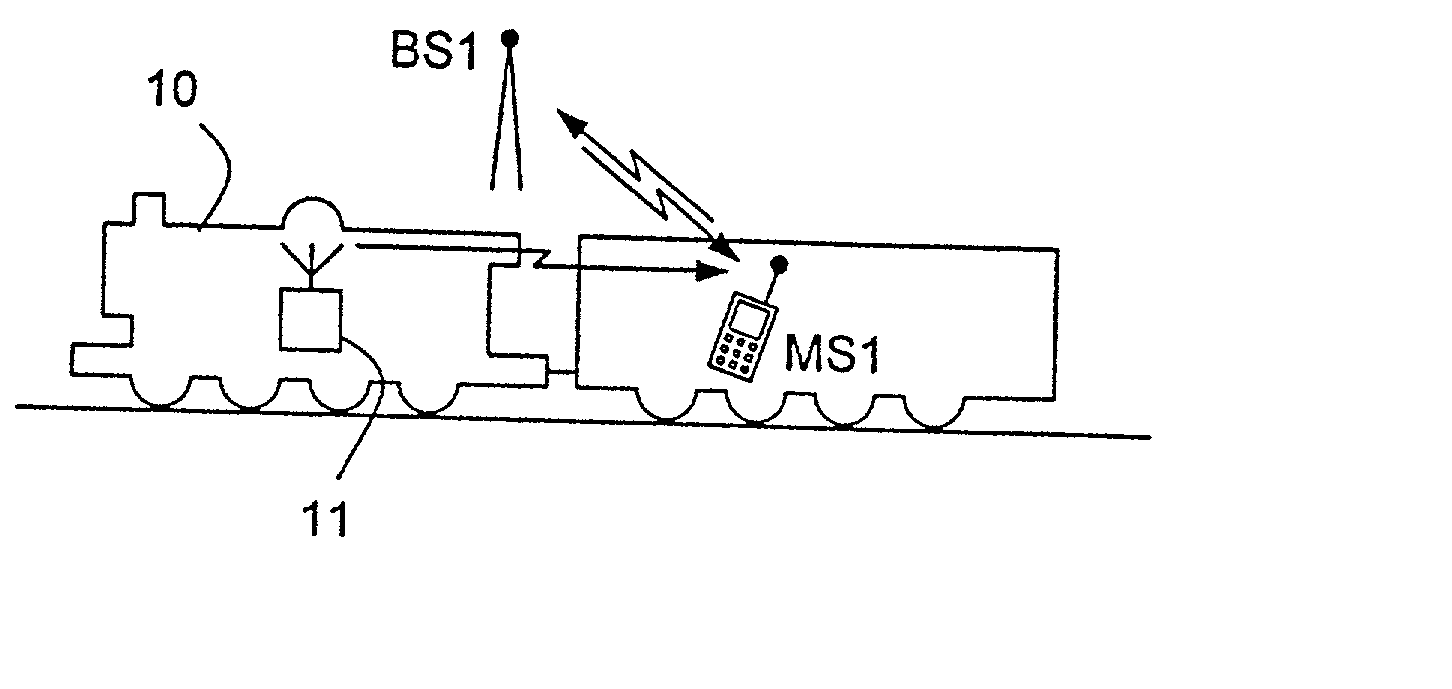

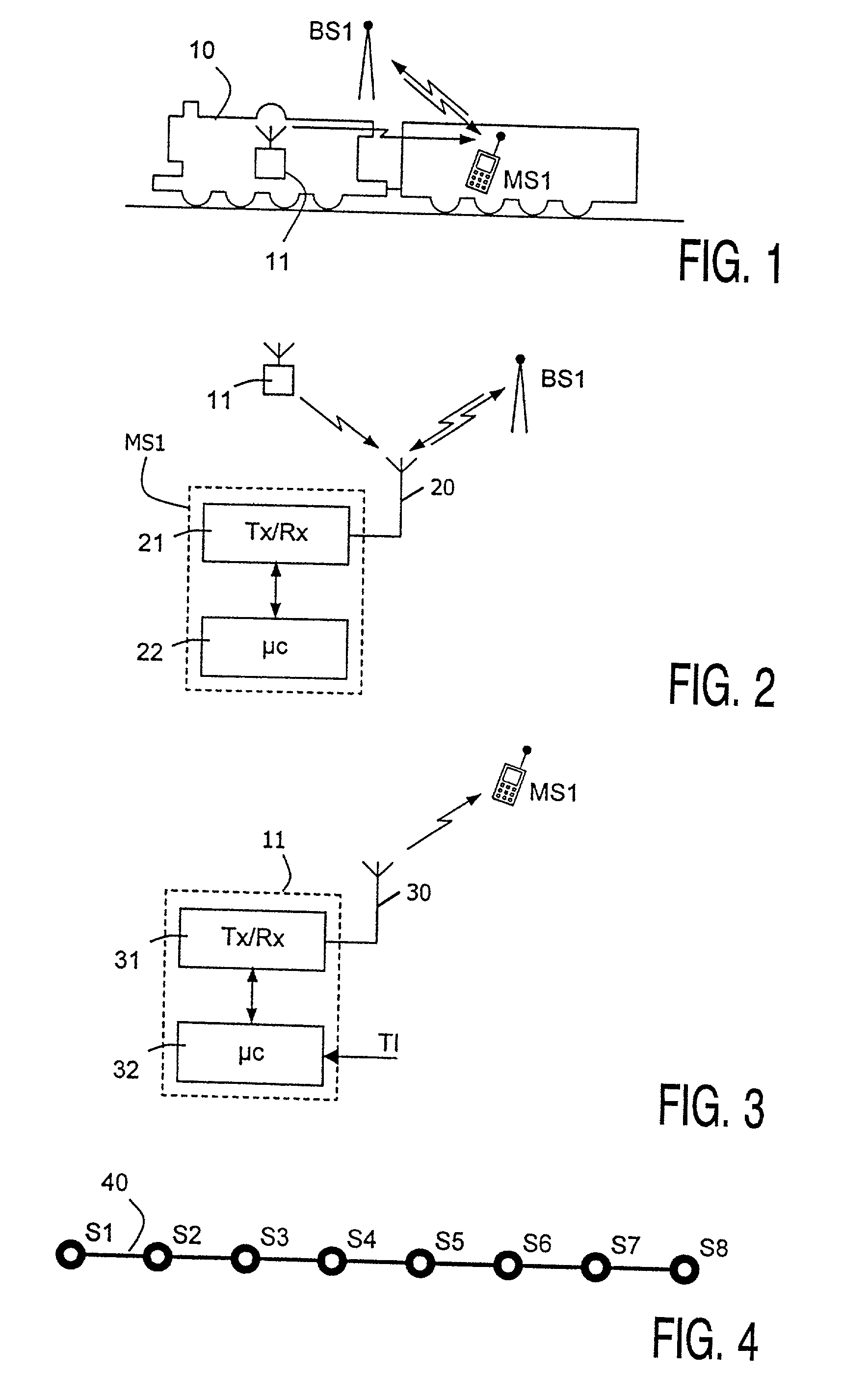

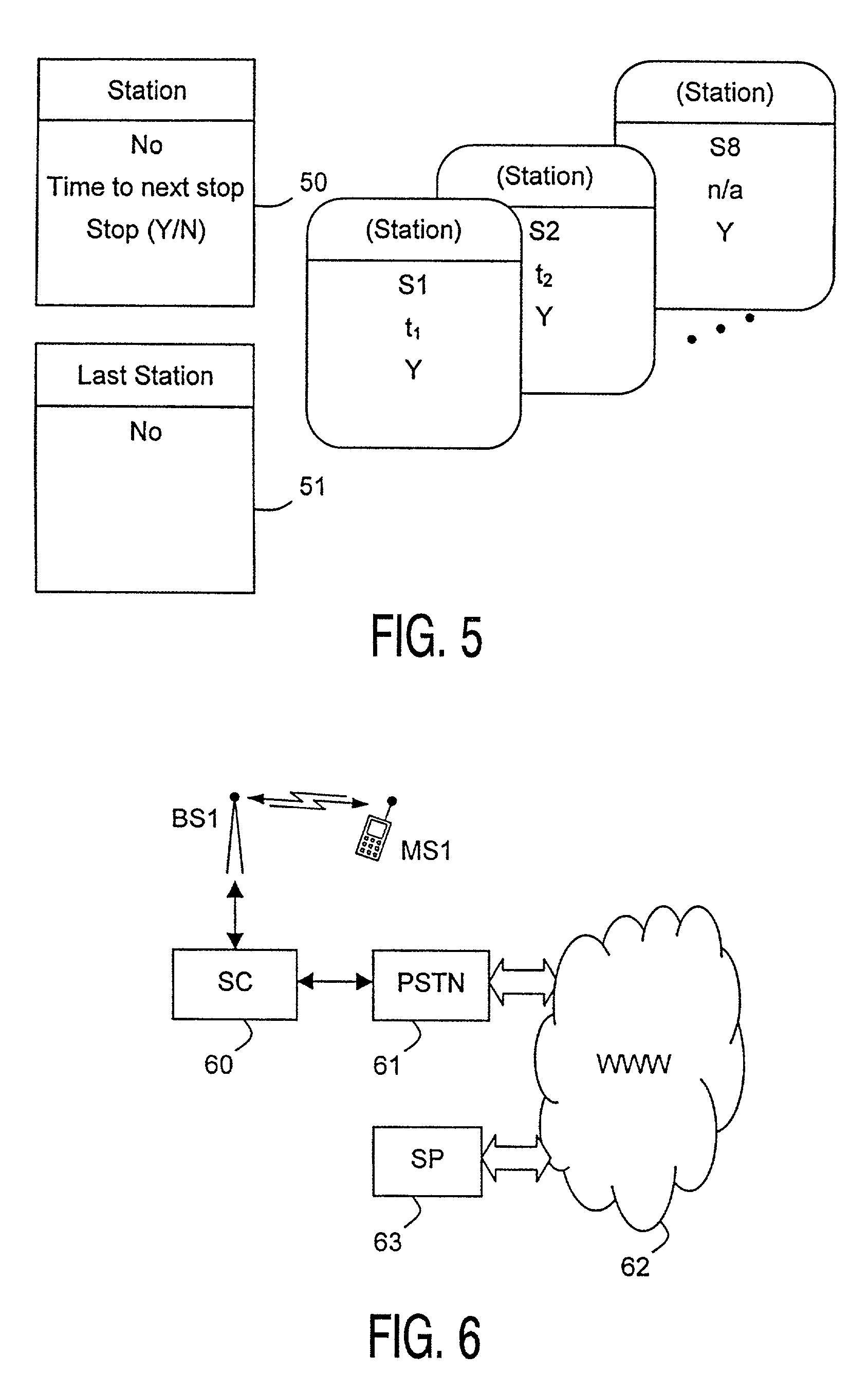

Method of providing travel information to a mobile communications device

InactiveUS20020077122A1Expand selectionIncrease likelihoodControl with pedestrian guidance indicatorRadio/inductive link selection arrangementsComputer scienceCommunication device

A method of providing travel related information to a user of a mobile communications device (MS1) is disclosed together with a corresponding mobile communications device (MS1) and a travel information beacon (11) for the same. The method comprising the steps of determining whether the mobile communications device (MS1) is either travelling on a transport (10), has recently traveled on a transport (10), or is likely to travel on a transport (10) at some time in the near future; and depending on the outcome of that determination, displaying to a user on the mobile communications device (MS1) selected travel related information.

Owner:KONINKLIJKE PHILIPS ELECTRONICS NV

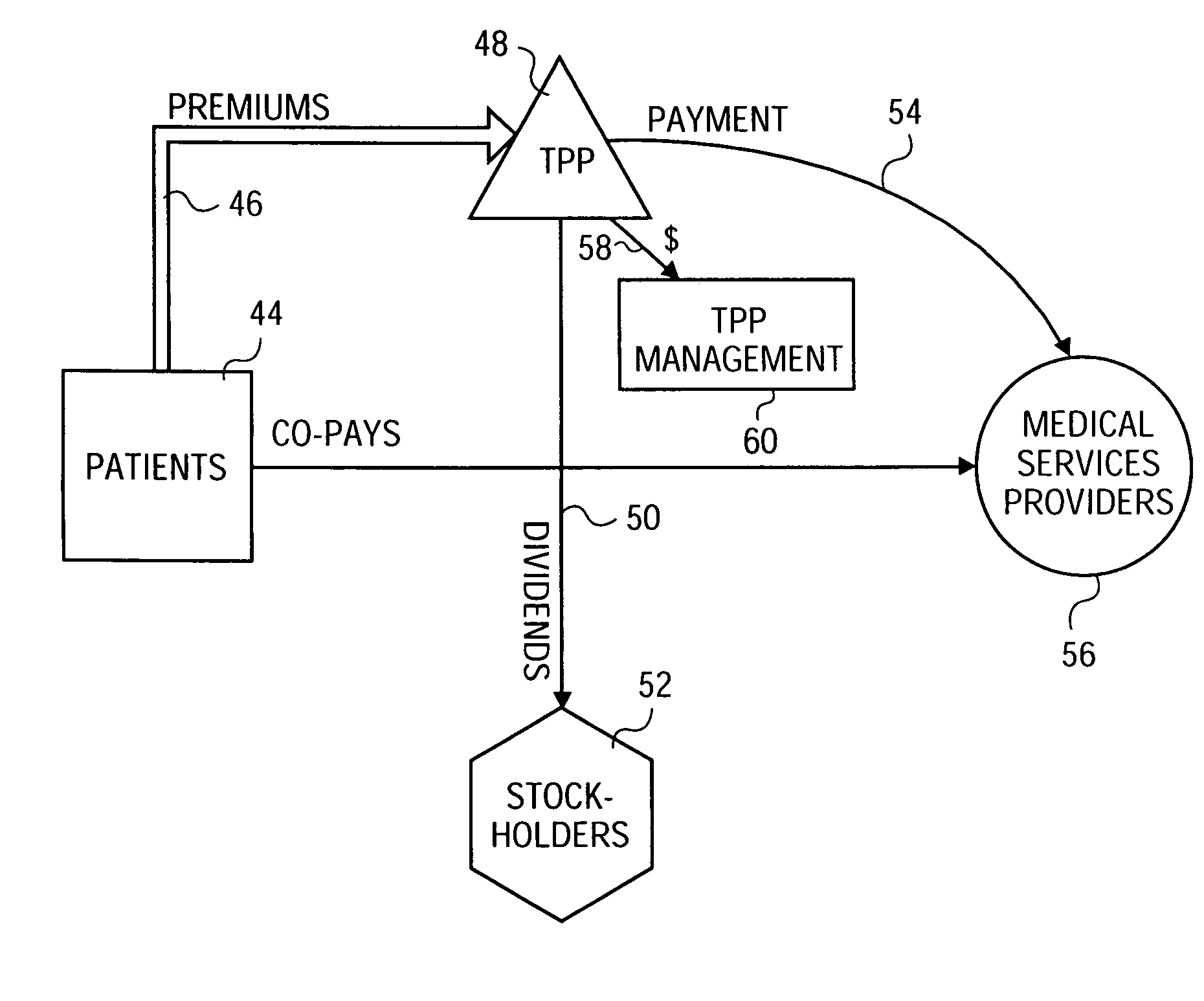

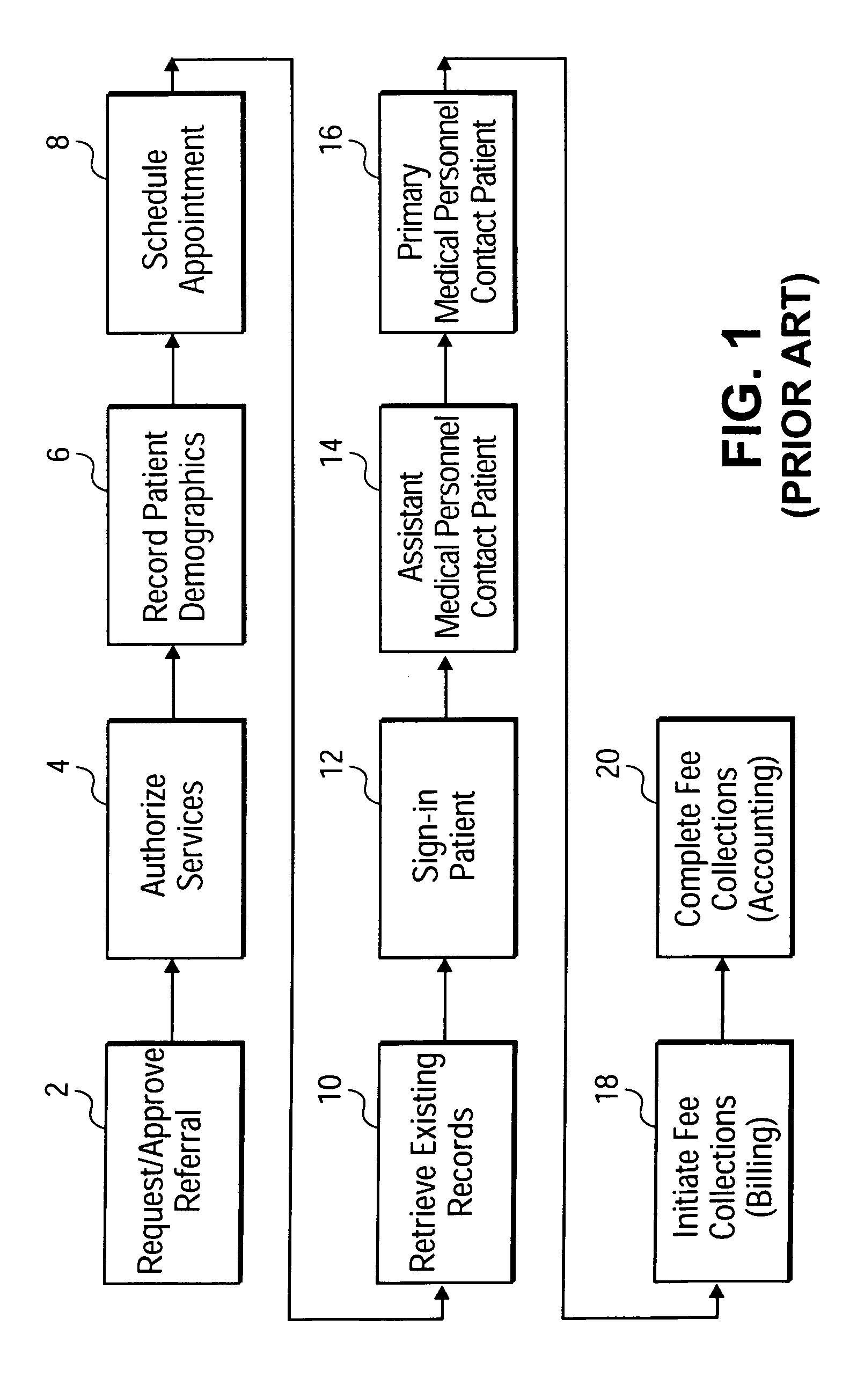

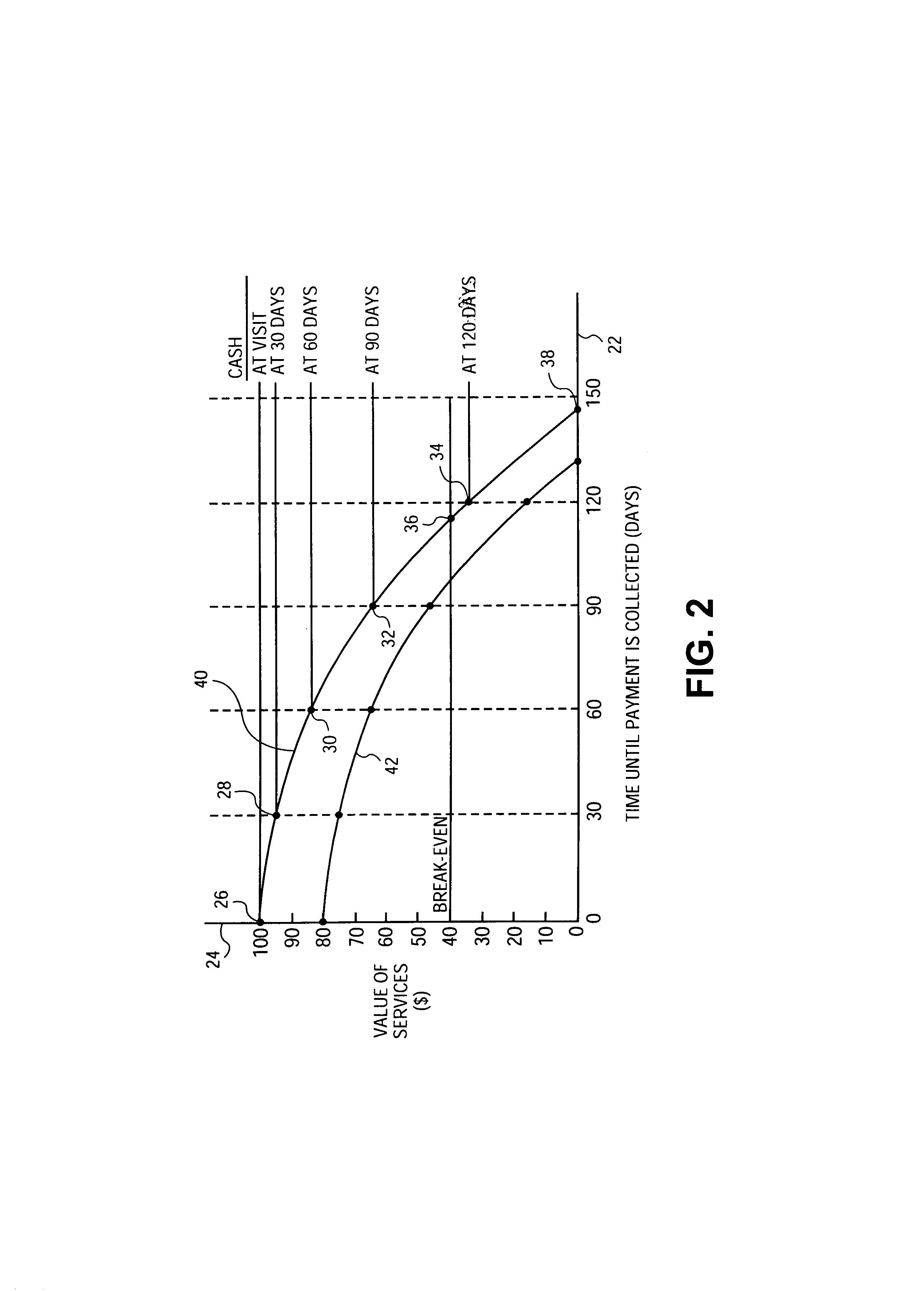

Method and apparatus for tracking the relative value of medical services

ActiveUS7702522B1Raise the possibilityMaximize profitabilityFinanceBilling/invoicingThird partyRelevant information

Methods and apparatus for tracking and evaluating the relative value, such as the net present value, of medical services provided to patients associated with third party payors (“TPPs”). Under various embodiments of the present invention, the relative value of medical services is considered in evaluating whether to enter into an agreement with a TPP, whether to accept a new patient, when and for how long to schedule a patient appointment, and how long a physician should meet with the patient. Methods and apparatus for improving the efficiency of a medical office are also disclosed whereby a physician may more effectively supply a patient with relevant information and provide prescriptions, record billing information, order supplies, and collect payment for services provided. Methods and apparatus for improving security within a medical office and reducing employee fraud are also disclosed.

Owner:SHOLEM STEVEN L

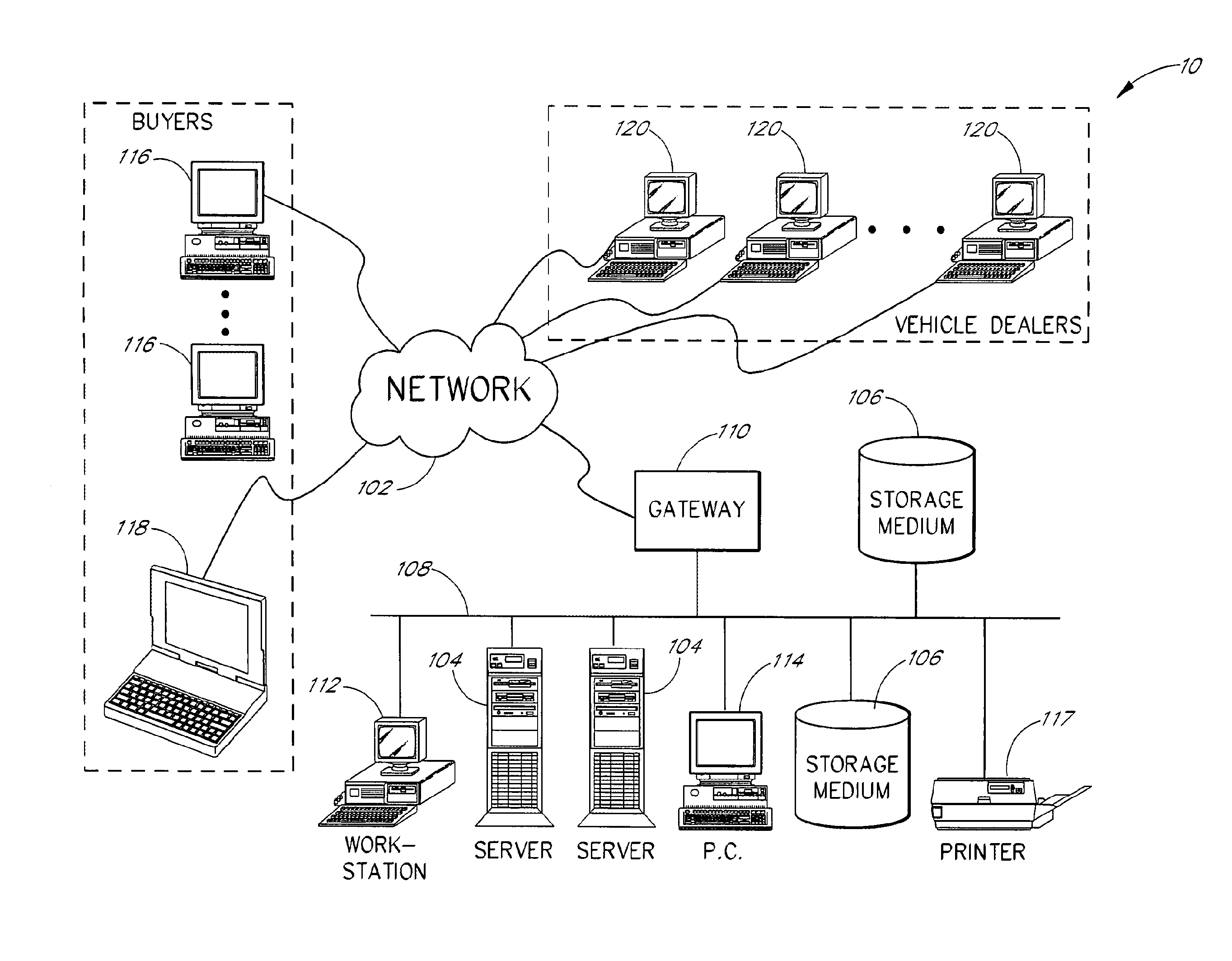

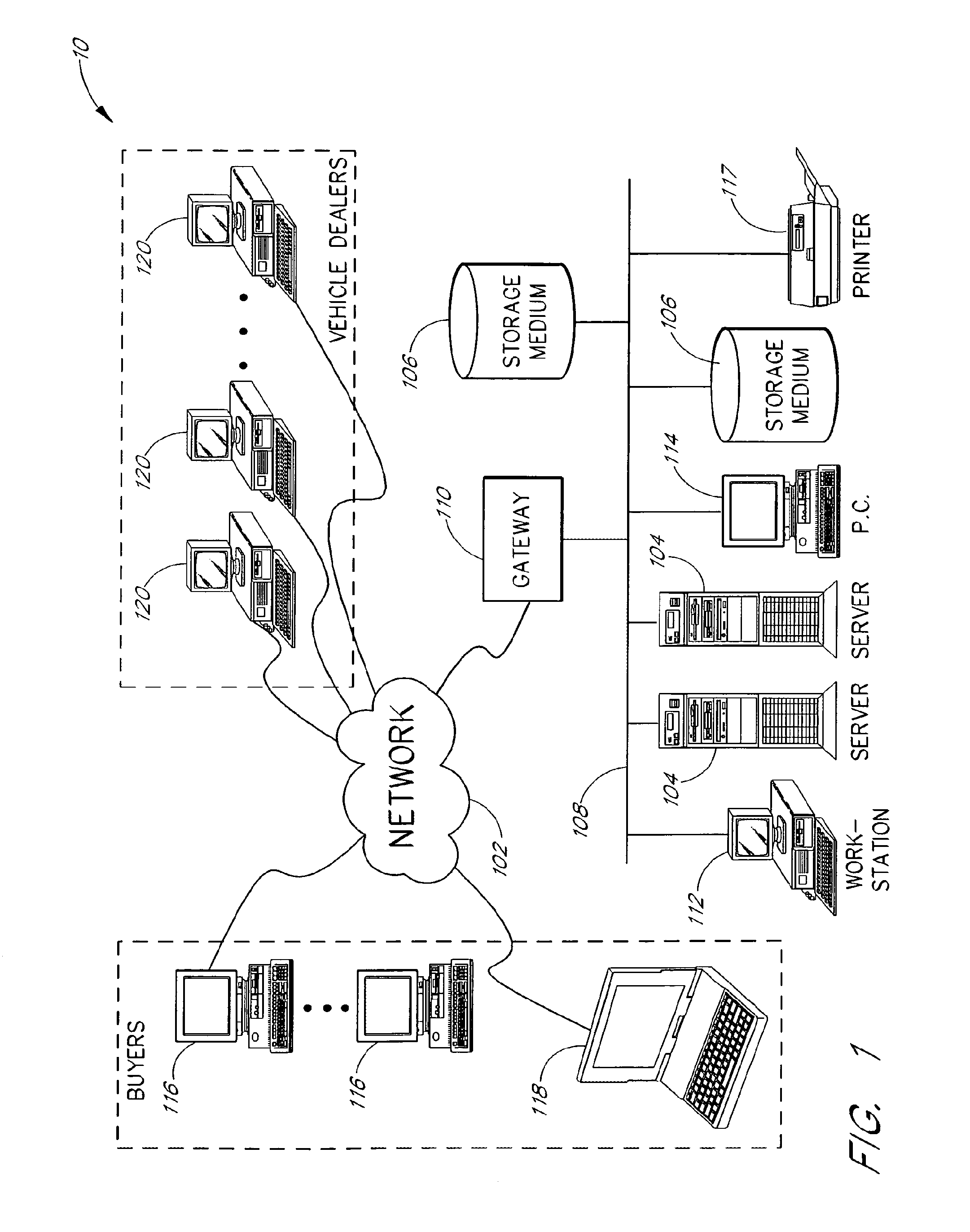

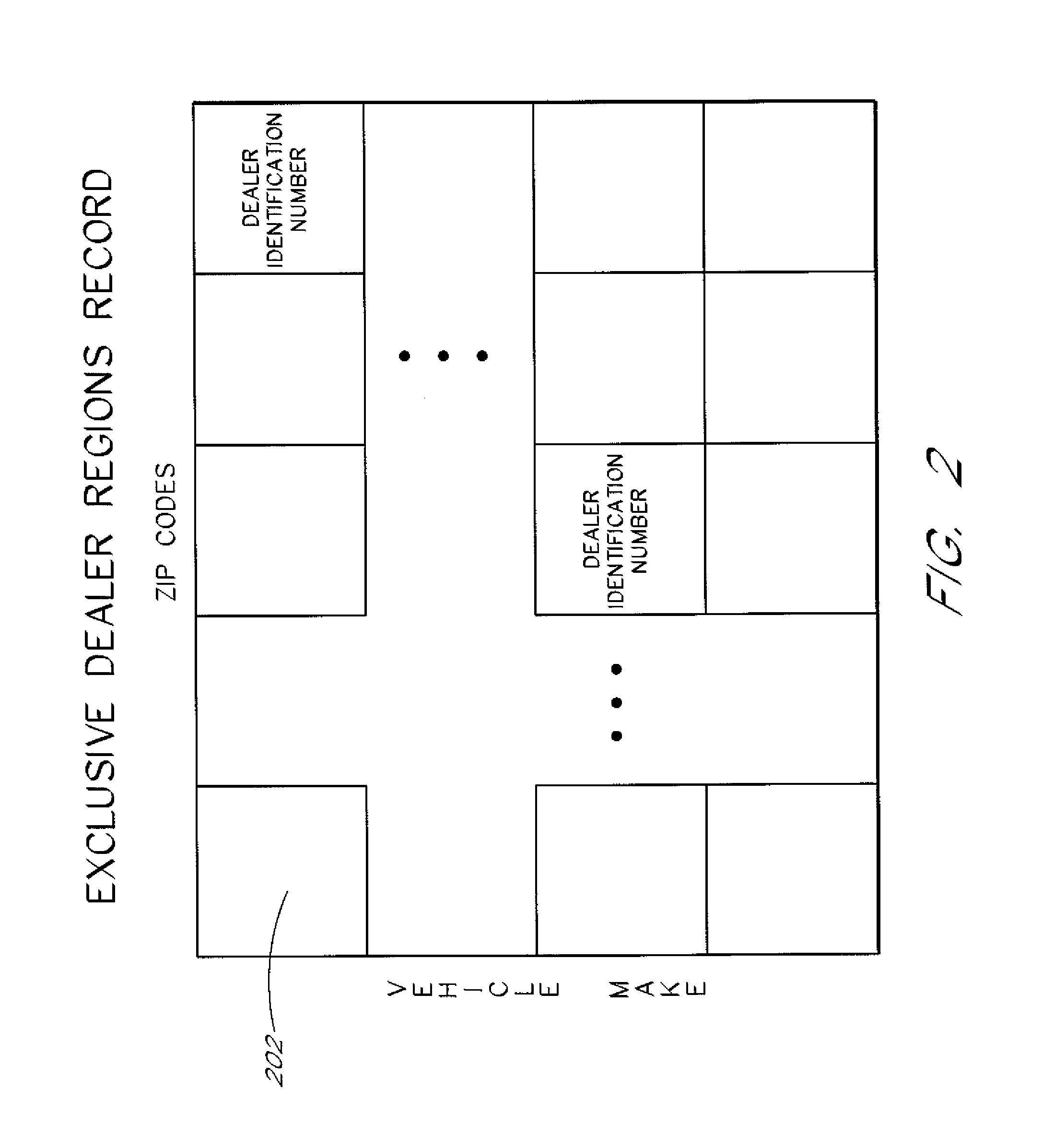

Methods of communicating purchase requests to vehicle dealers

InactiveUS7536318B1Efficient managementEfficiently and advantageously actFinancePayment architectureData centerLibrary science

A method and apparatus for communicating a purchase request to a dealer immediately. A Data Center system has a system database accessible to a plurality of dealers. A potential buyer submits a purchase request over a computer network to the Data Center system. The purchase request may include product identification data and buyer location information. The Data Center system identifies at least one appropriate dealer to receive the purchase request. The Data Center creates a purchase request record from the data and information provided in the purchase request. The Data Center then communicates the purchase request to the appropriate dealer by immediately storing the purchase request record into the system database such that the purchase request is accessible only to the at least one identified dealer. The purchase request becomes available to the at least one identified dealer immediately upon the creation of the purchase request record.

Owner:AUTOBYTEL

Normothermic tissue treatment

InactiveUS6840915B2Drying of woundPrevent evaporationCannulasEnemata/irrigatorsElectrical resistance and conductanceAdhesive

A non-contact controllable heater wound covering and method having a peripheral sealing ring covered by a layer to which is attached a heater and this assembly is attached to the skin with an adhesive so that the heater is held proximate the wound area in a non-contact position. The layer and peripheral sealing ring together define a treatment volume proximate the wound. The wound covering includes a programmable active heater control and the sealing ring may dispense water to control the humidity of the treatment volume. One form of active heat is an electrical resistive filament in variable geometric shapes providing versatility in application of heat to different types of wounds and wound area geometries. Another form of active heat is the transfer of a heated gas to the wound covering.

Owner:GEN ELECTRIC CAPITAL

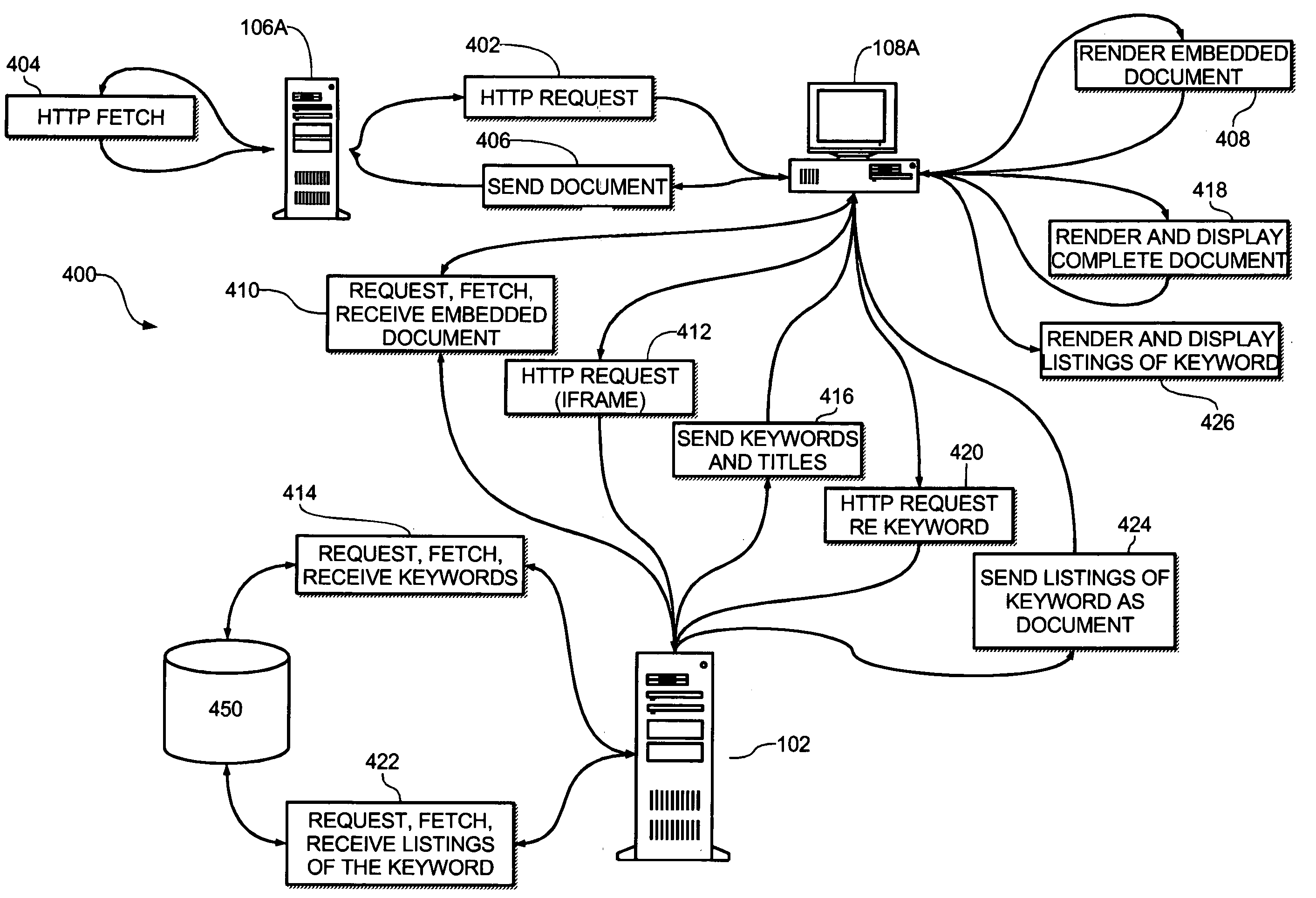

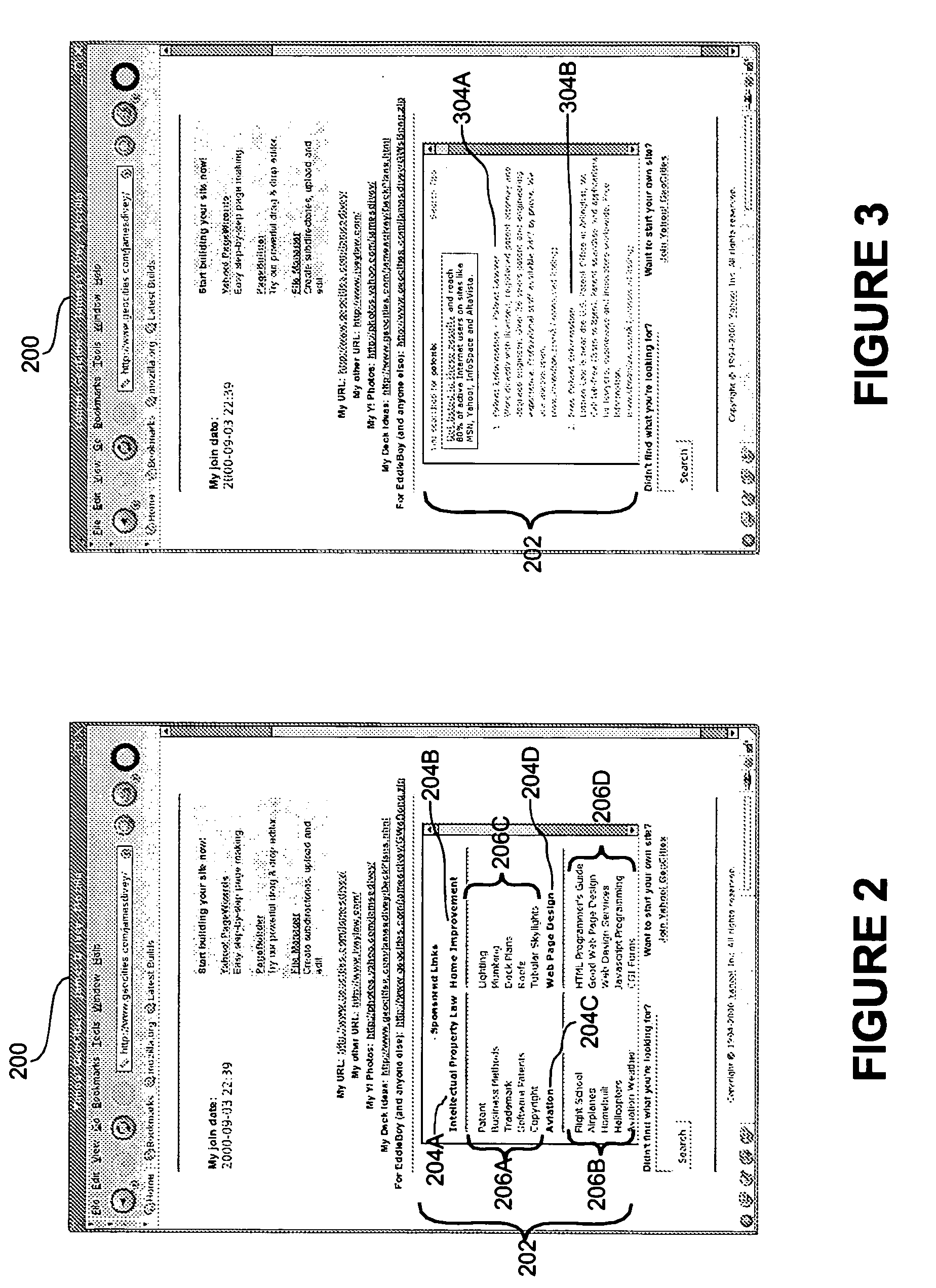

Efficiently spaced and used advertising in network-served multimedia documents

InactiveUS20060015401A1Efficiently presentedRaise the possibilityMarketingDocumentationNetwork service

A two-stage sponsored link mechanism is embedded in a Web page such that the amount of available information to the user is exponentially related to the space devoted to the sponsored links. In the first stage, a server provides categories and topics, in the form of searchable keywords, for inclusion in the Web page. In the second stage, the user clicks on one of the keywords under one of the categories to generate a search request for search listings associated with the keyword. The server returns a number of search listings selected according to the value attributed to each search listing by its owner. By providing multiple topics to the user, the likelihood the user will find information of interest, and thus access of such adjunct information, is significantly increased.

Owner:OATH INC

Vacuum insulated glass (VIG) unit including nano-composite pillars, and/or methods of making the same

ActiveUS20120088045A1Accelerate breakageIncrease likelihoodClimate change adaptationLaminationHigh intensitySoft materials

Certain example embodiments of this invention relate to composite pillar arrangements for VIG units that include both harder and softer materials. The softer materials are located on the outside or extremities of the central, harder pillar material. In certain example embodiments, a high aspect ratio mineral lamellae is separated by an organic “glue” or polymer. When provided around a high strength pillar, the combination of the pillar and such a nano-composite structure may advantageously result in superior strength compared to a monolithic system, e.g., where significant wind loads, thermal stresses, and / or the like are encountered.

Owner:GUARDIAN GLASS LLC

Angioplasty cutting device and method for treating a stenotic lesion in a body vessel

ActiveUS20070106215A1Simple and efficient and cost-effectiveEfficient and effectiveBalloon catheterCannulasStenotic lesionBlood vessel

An integrally formed angioplasty cutting device for balloon angioplasty of a stenotic lesion in a body vessel. The device comprises a distal collar and a proximal collar. The device further comprises at least one strut integrally formed with the distal collar and the proximal collar. At least one of the collars has a slot formed therethrough defining a C-shaped configuration. The strut is configured to be disposed at the stenotic lesion to engage the stenotic lesion for dilatation of the body vessel during angioplasty.

Owner:COOK MEDICAL TECH LLC

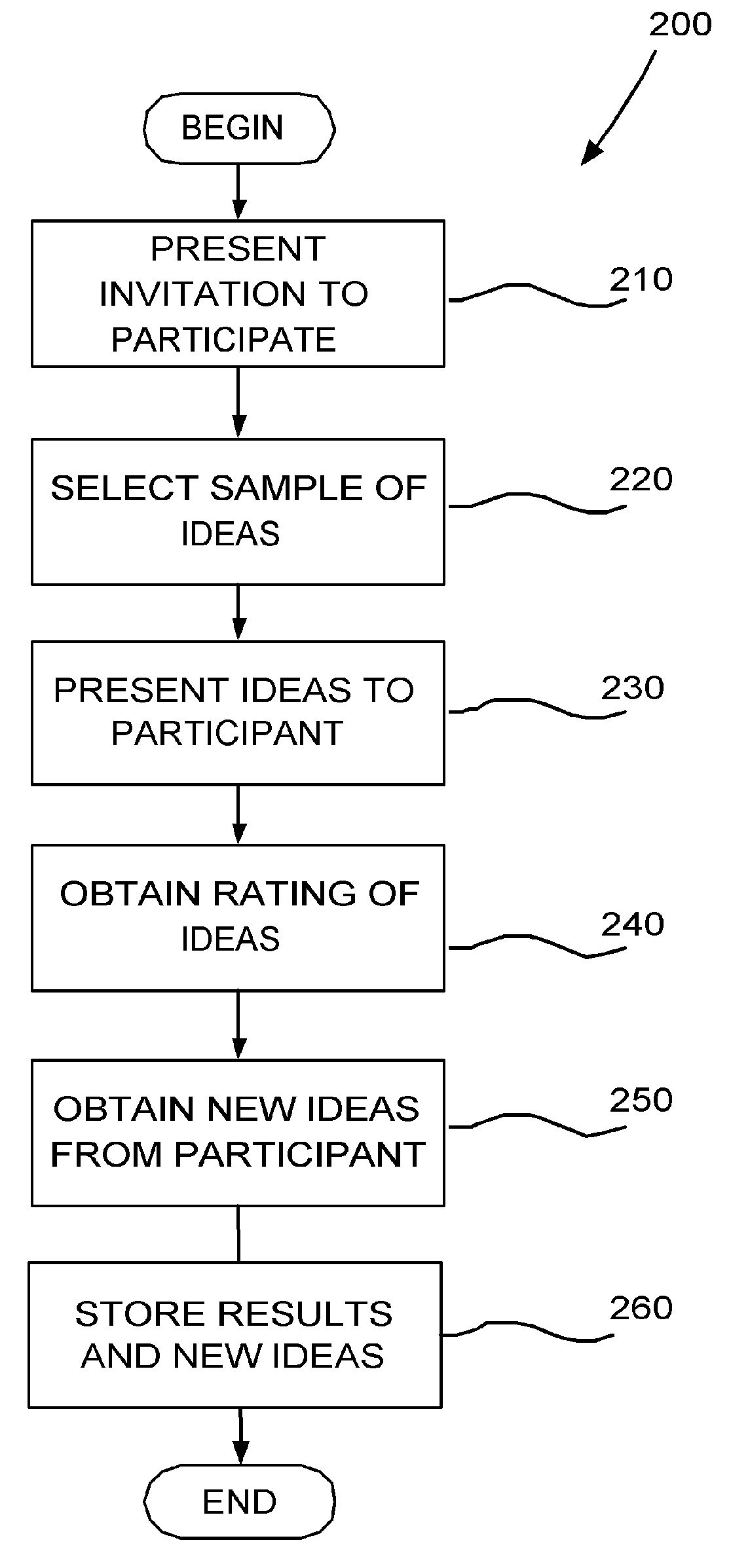

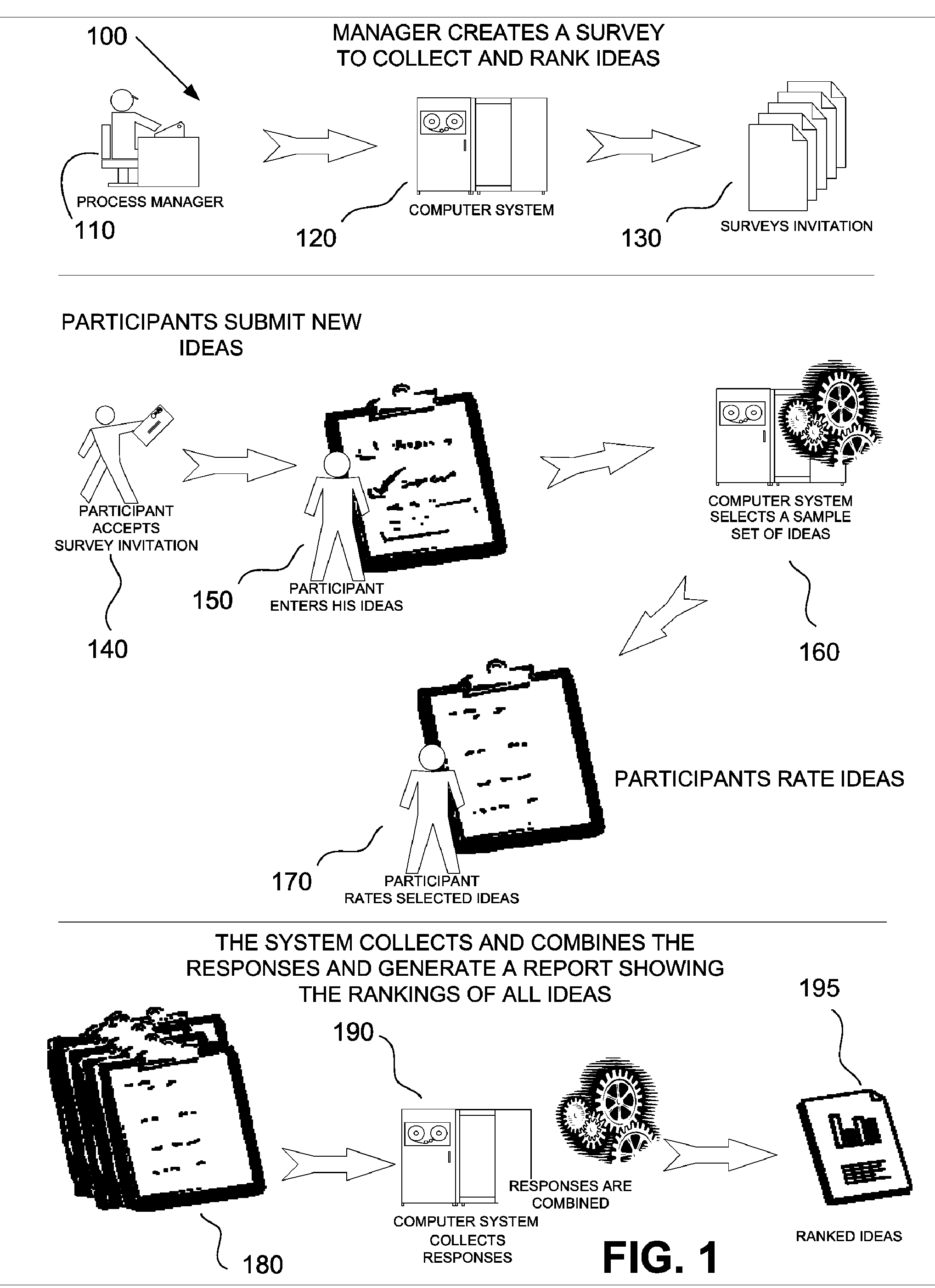

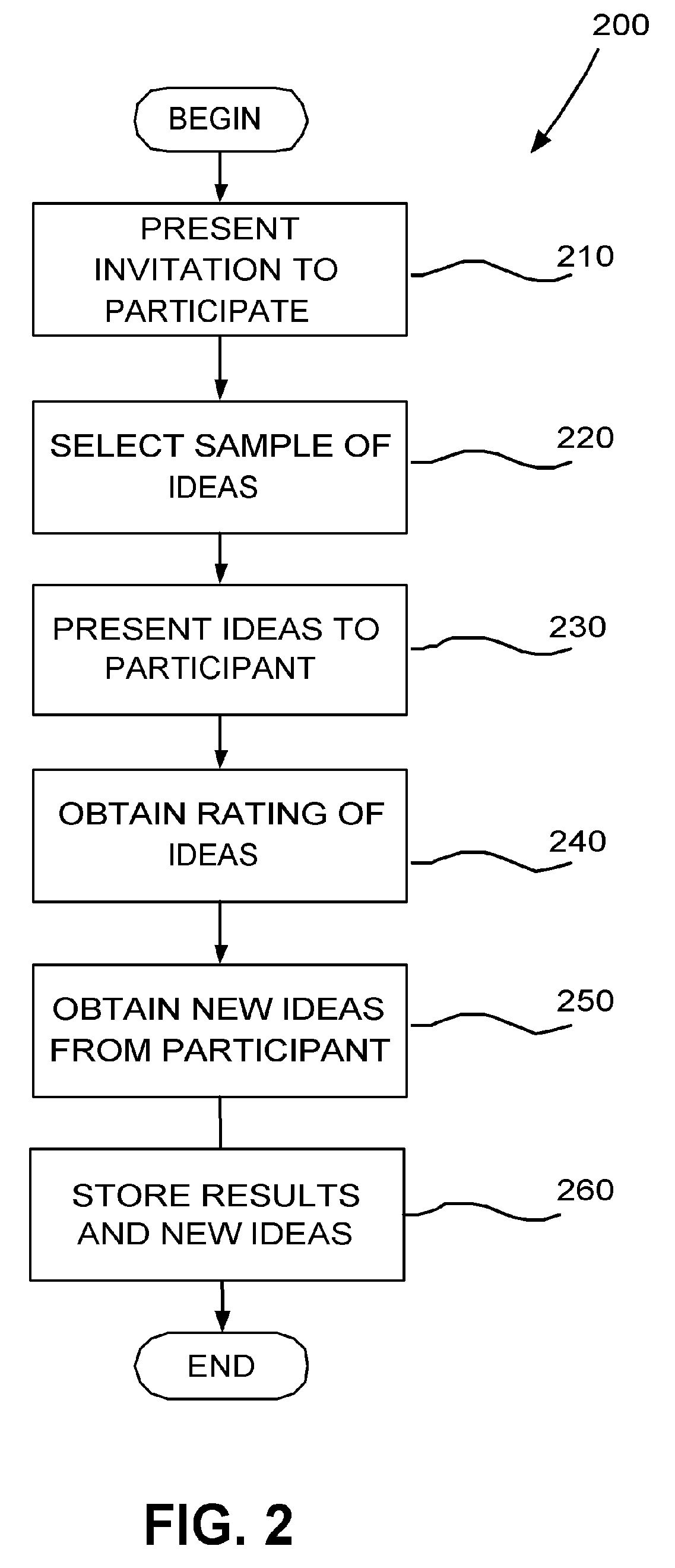

Confidence based selection for survey sampling

InactiveUS20060121434A1Increase the number ofAmount of timeMarket predictionsElectrical appliancesSurvey samplingSelection algorithm

A system and method for confidence-based selection of items for use in conducting a computer-implemented survey. The survey presents information about a selected plurality of items to a survey participant, to elicit survey feedback information. Information regarding the plurality of items is stored, the stored information including display information about each of the plurality of items for presentation to a survey participant. A subset of items for presentation to a survey participant is selected in accordance with a predetermined selection algorithm. Information corresponding to the selected subset of items is displayed to the survey participant via a survey user interface. Rating information is input by the survey participant via the survey user interface indicating the survey participant's preferences as to items in the presented subset of items. The rating information is utilized in various manners to affect the selection algorithm for a subsequent survey.

Owner:RYMA TECH SOLUTIONS

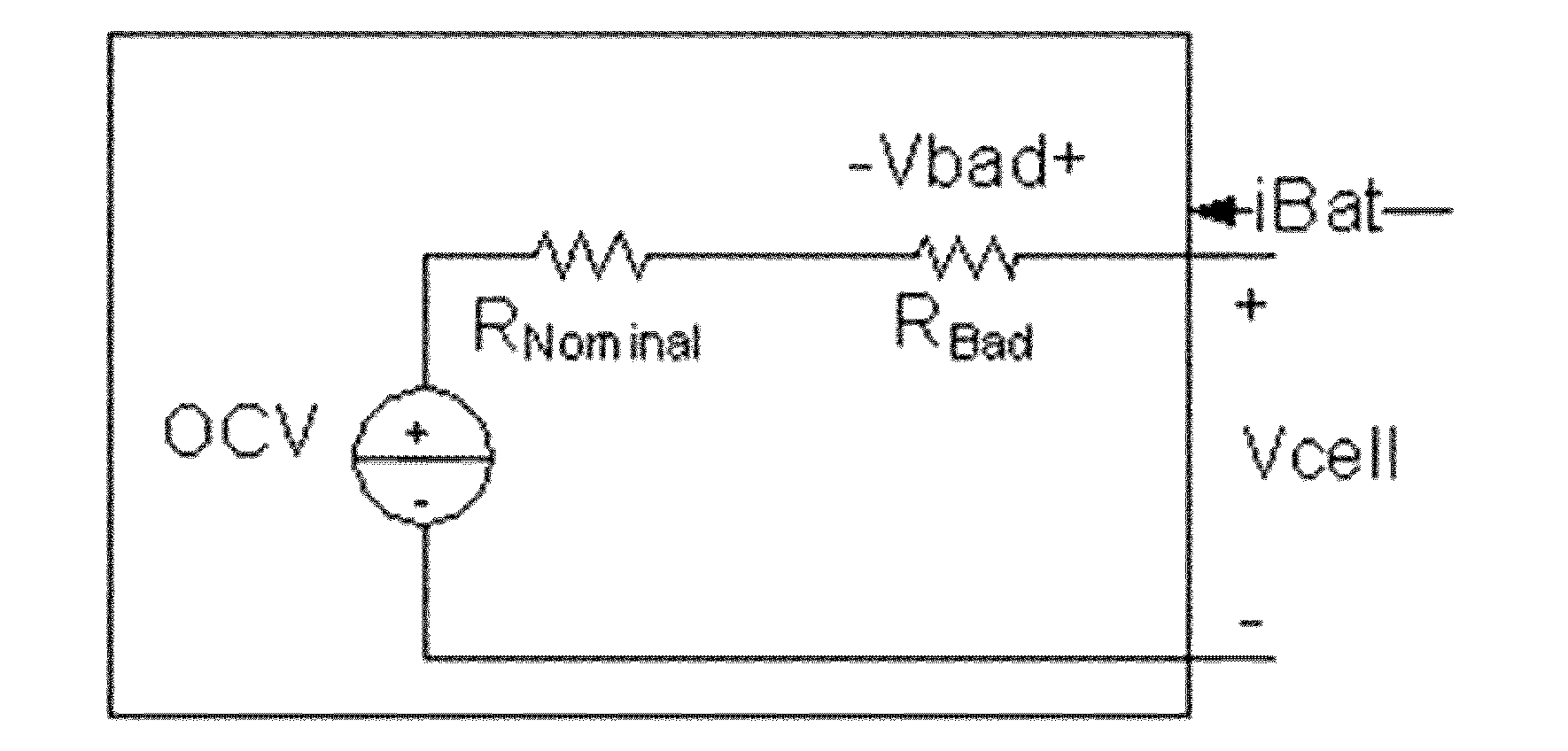

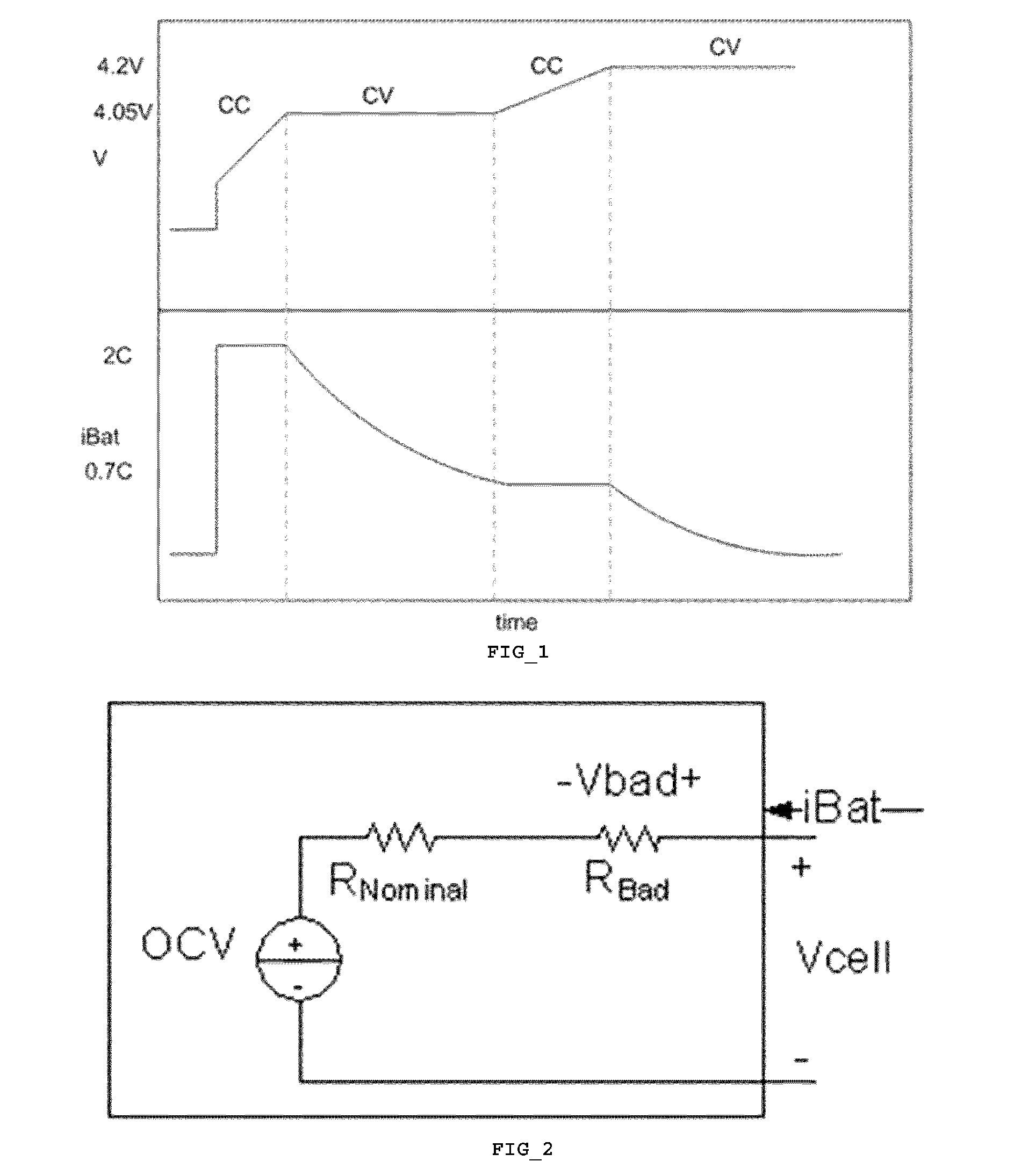

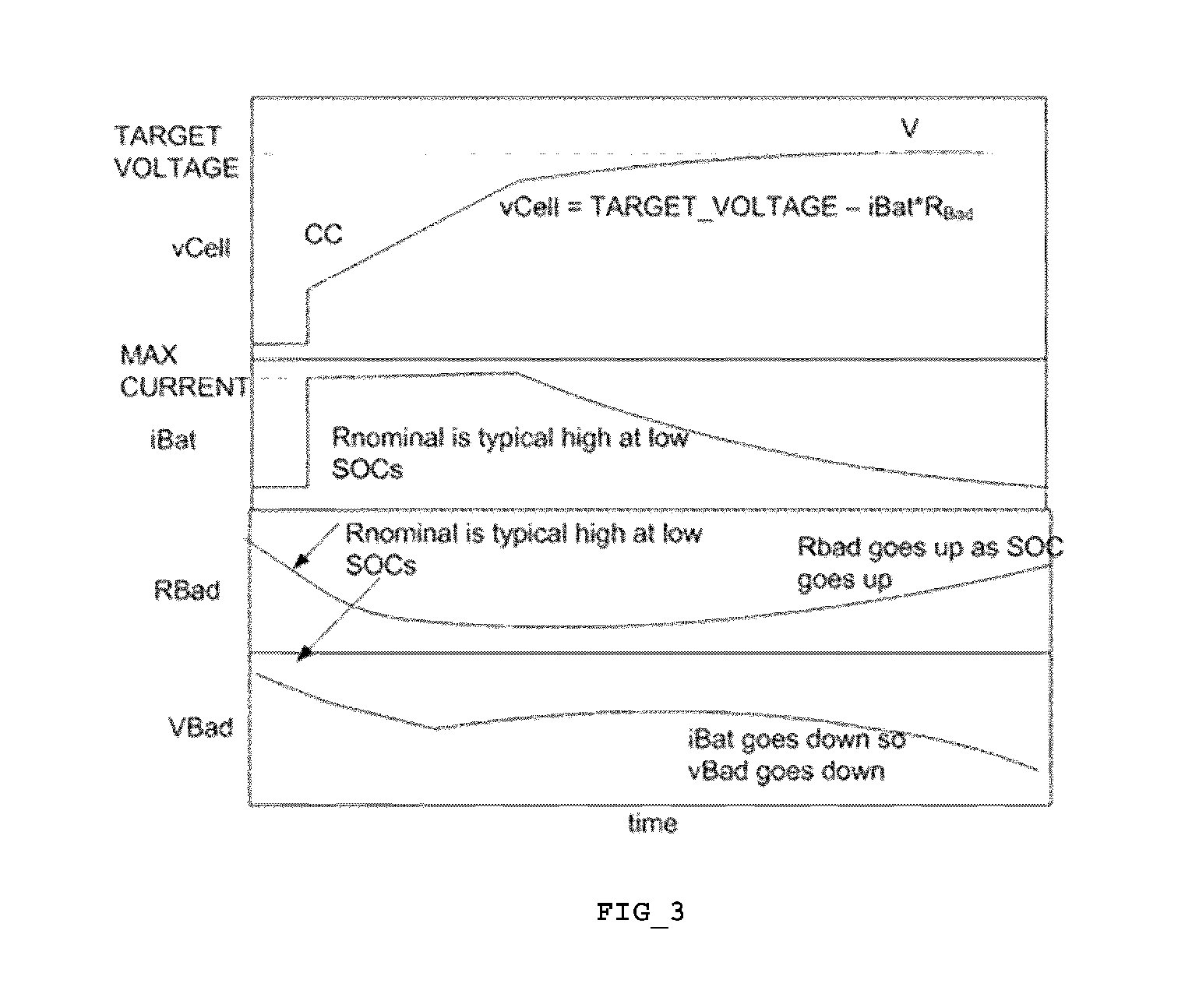

Low temperature charging of li-ion cells

ActiveUS20110012562A1Reduce charging currentIncrease charging rateBatteries circuit arrangementsElectric powerCharge currentCelsius Degree

A battery cell charging system, including a charger and a controller, for low-temperature (below about zero degrees Celsius) charging a lithium ion battery cell, the battery cell charging system includes: a circuit for charging the battery cell using an adjustable voltage charging-profile to apply a charging voltage and a charging current to the battery cell wherein the adjustable voltage charging-profile having: a non-low-temperature charging stage for charging the battery cell using a charging profile adapted for battery cell temperatures above about zero degrees Celsius; and a low-temperature charging stage with a variable low-temperature stage charging current that decreases responsive to a battery cell temperature falling below zero degrees Celsius.

Owner:TESLA INC

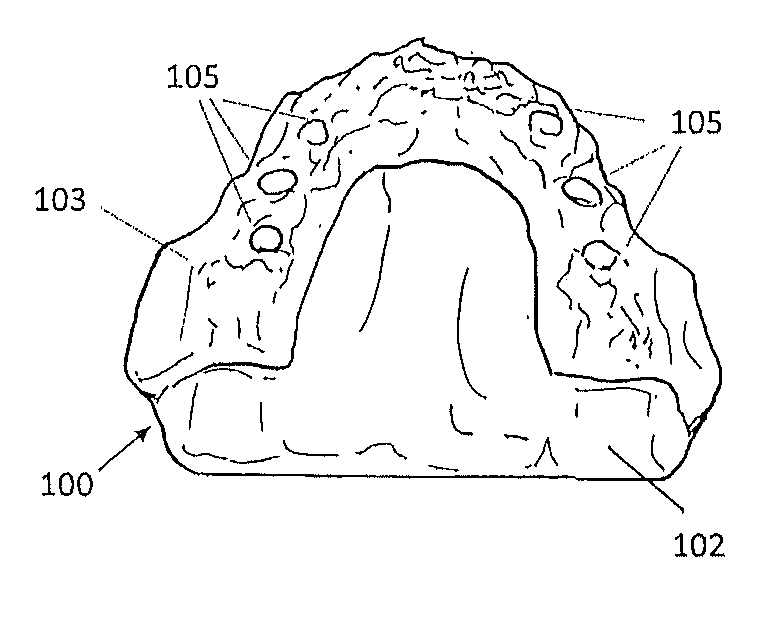

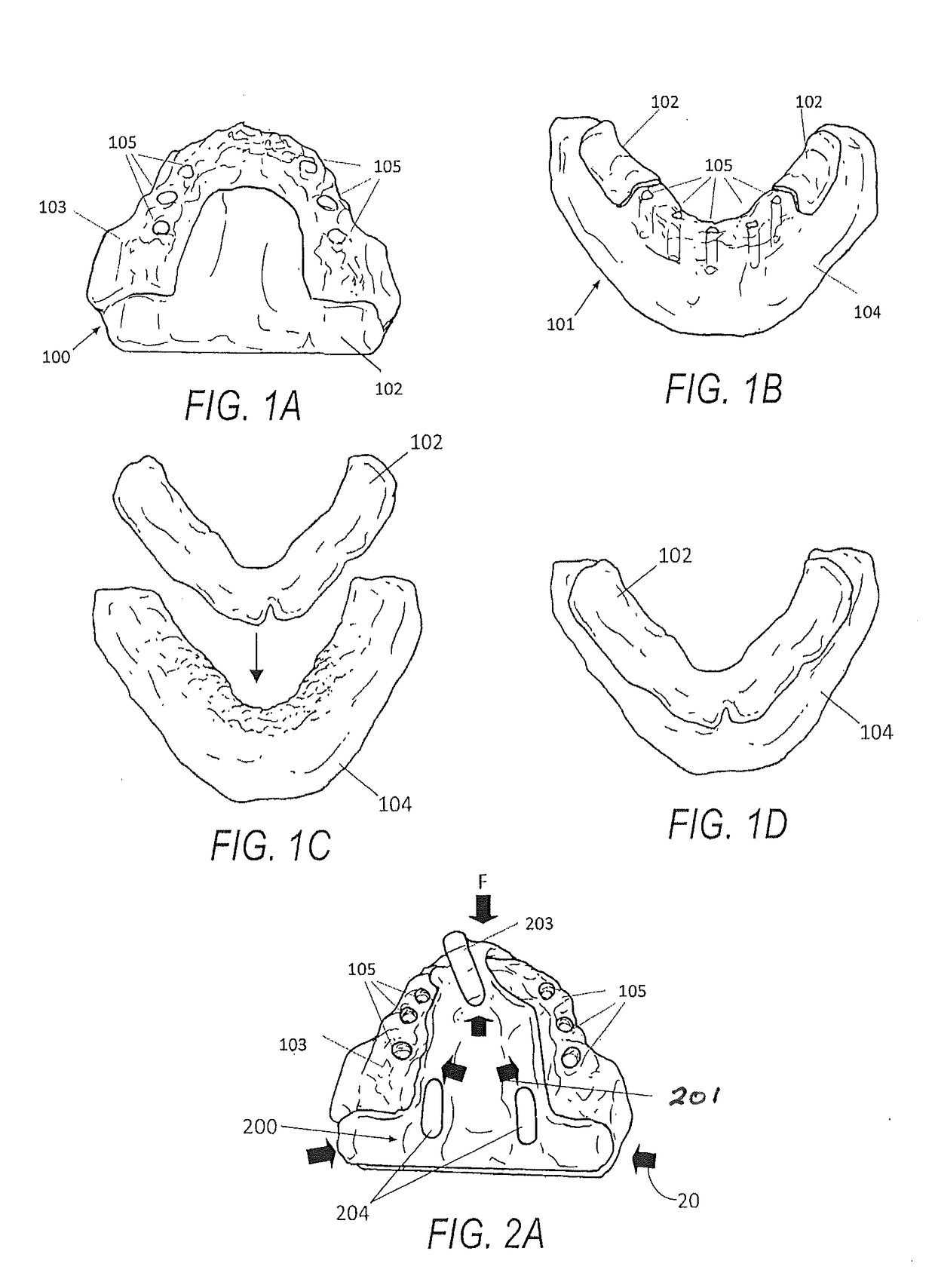

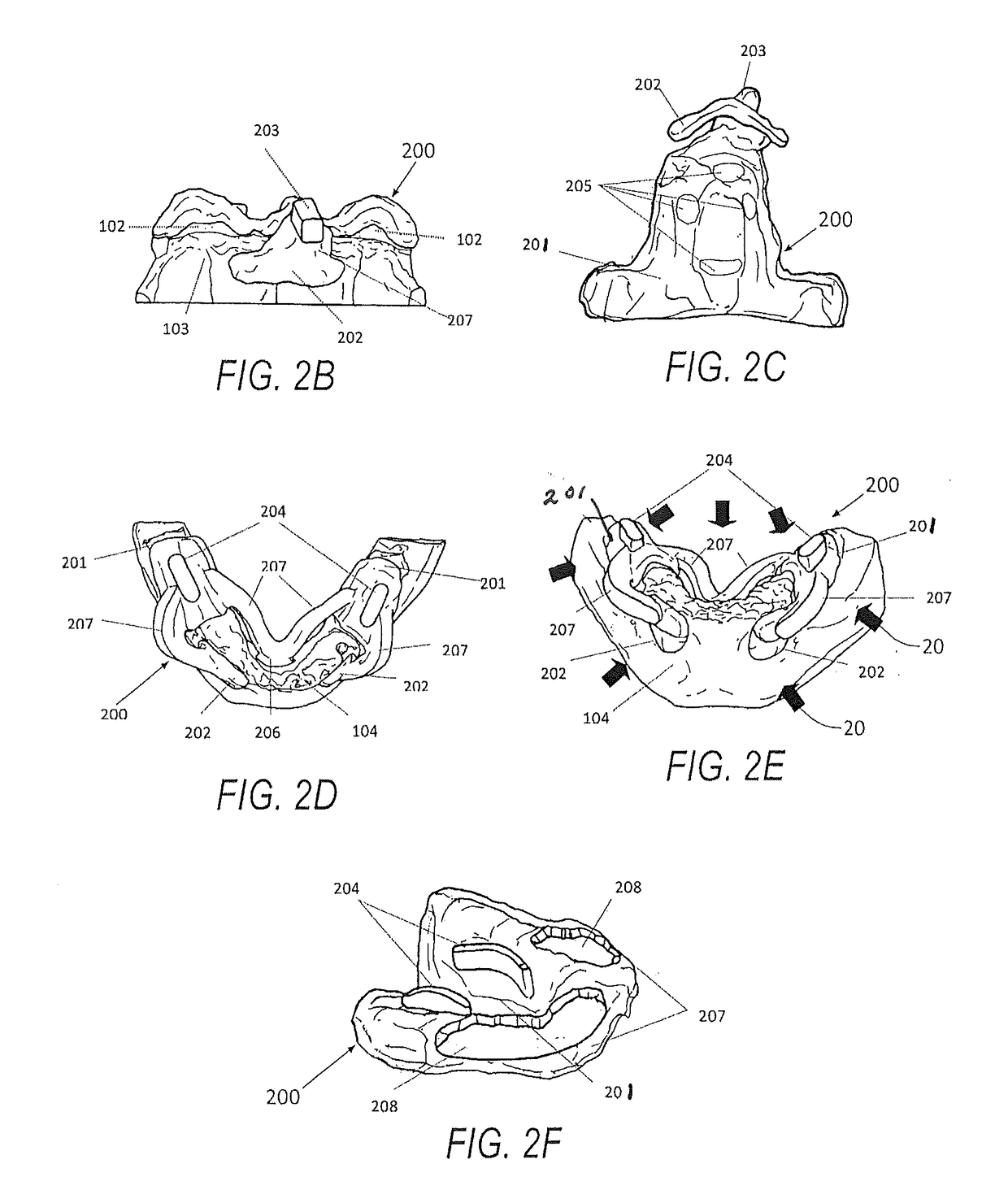

Method of using an endentulous surgical guide

ActiveUS20170112592A1Shorten the timeRelieve pressureDental implantsAdditive manufacturing apparatusBite registrationDental Models

An approach is disclosed that involves creating an updated master dental model of a patient's mouth after an implant surgery by aligning new postoperative oral scan data to pre-existing preoperative oral scan data that is more comprehensive (e.g., it includes bite registration). Before surgery a multi-piece stackable surgical guide set is created using the preoperative oral scan data. The surgical guide set is used to facilitate the surgery. After the surgery at least one piece of the surgical guide set is placed back in a patient's mouth and may act as a reference marker because it was created using the preoperative oral scan data, but is also part of the postoperative mouth configuration since it was used to facilitate the surgery. The affected portion of the mouth may then be digitally scanned directly or indirectly by way of a physical impression with the reference marker in place to determine the new characteristics resulting from the surgery such as new implant installation locations and orientations. The new postoperative oral scan data may be combined with the pre-existing preoperative oral scan data by way of the reference marker (since it is a constant between the two sets of scan data) without having to do such things as take a new bite registration, on which a new implant restoration can be easily created.

Owner:IBUR

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com