Patents

Literature

133results about How to "Minimal requirement" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

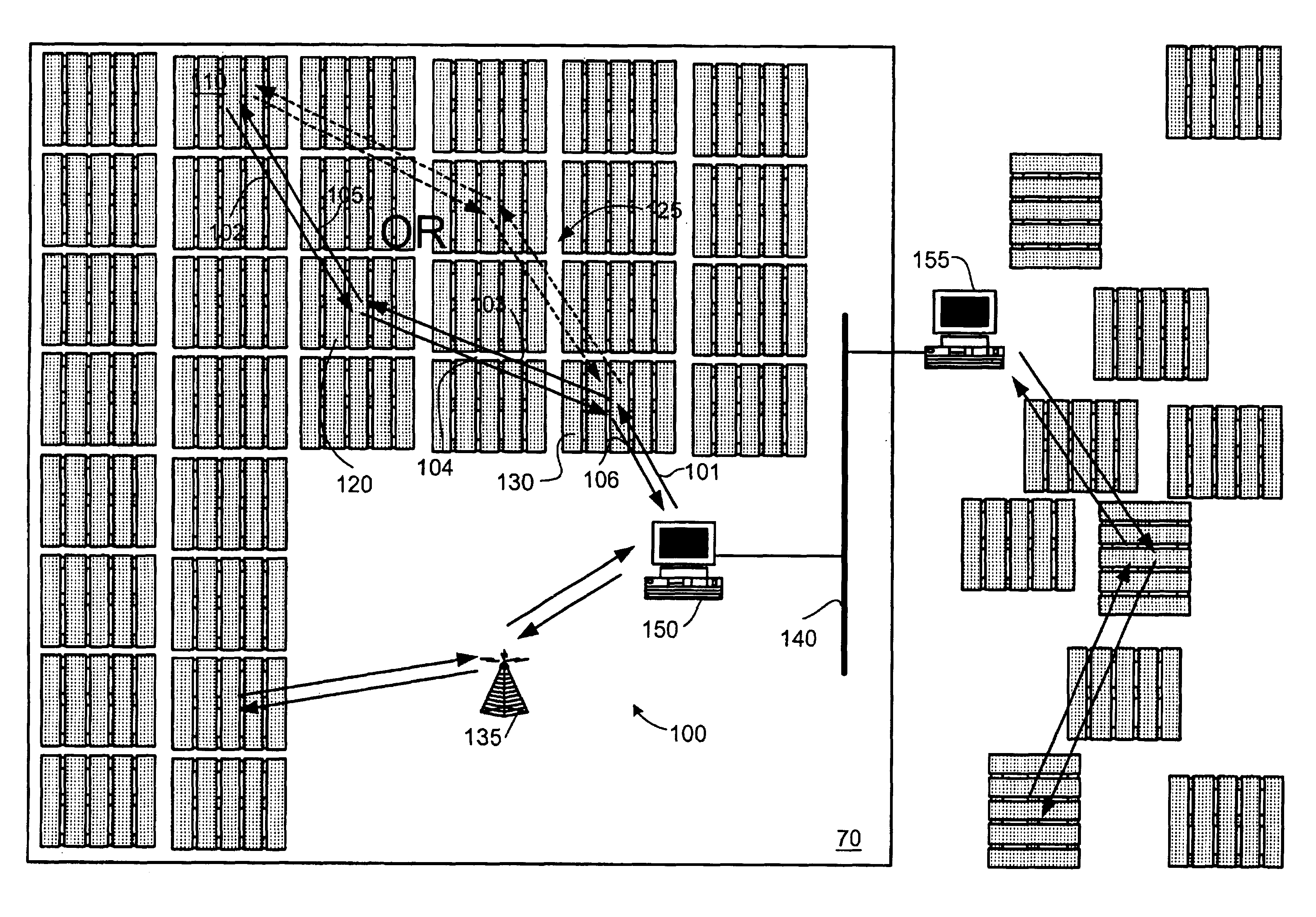

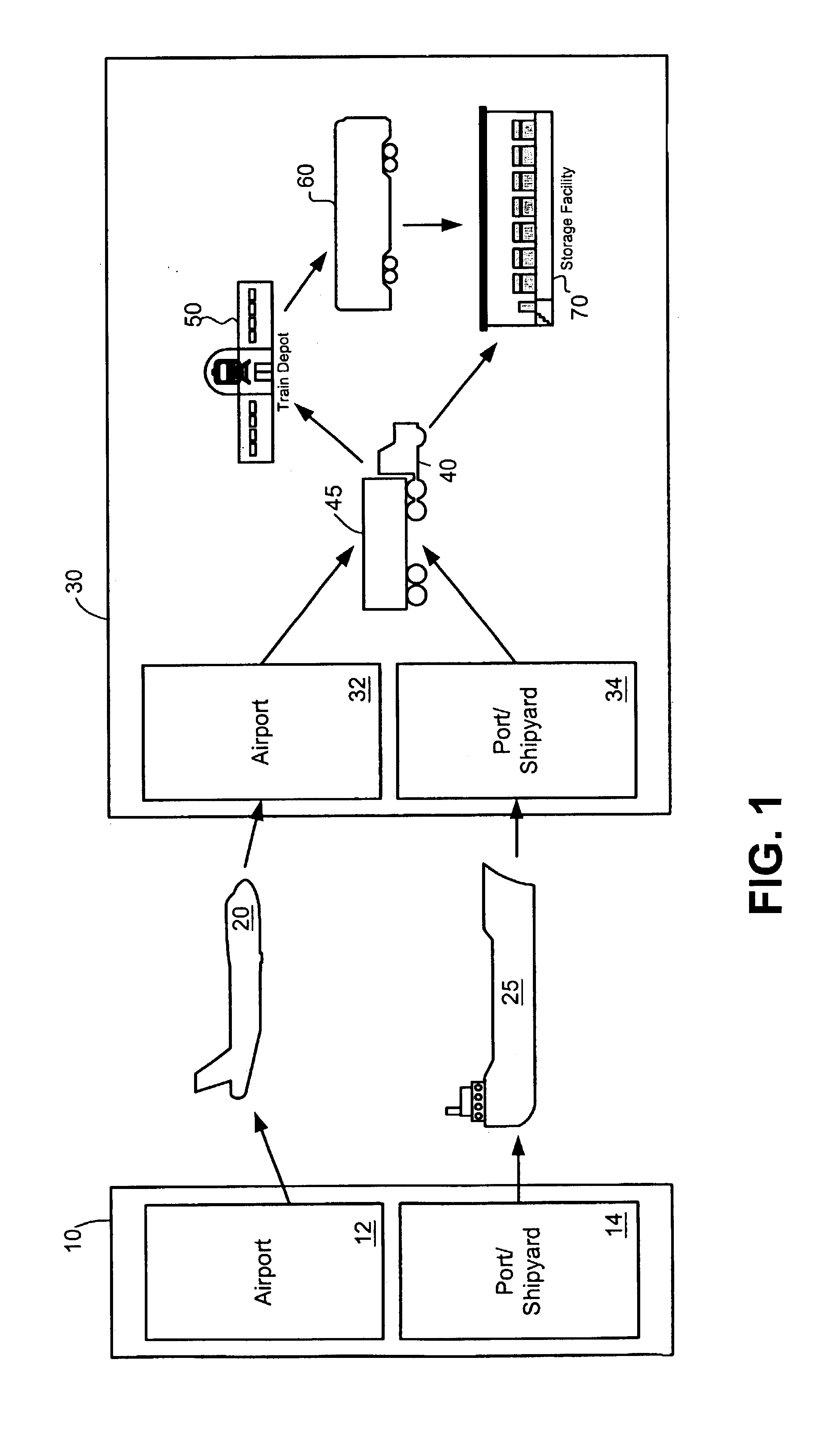

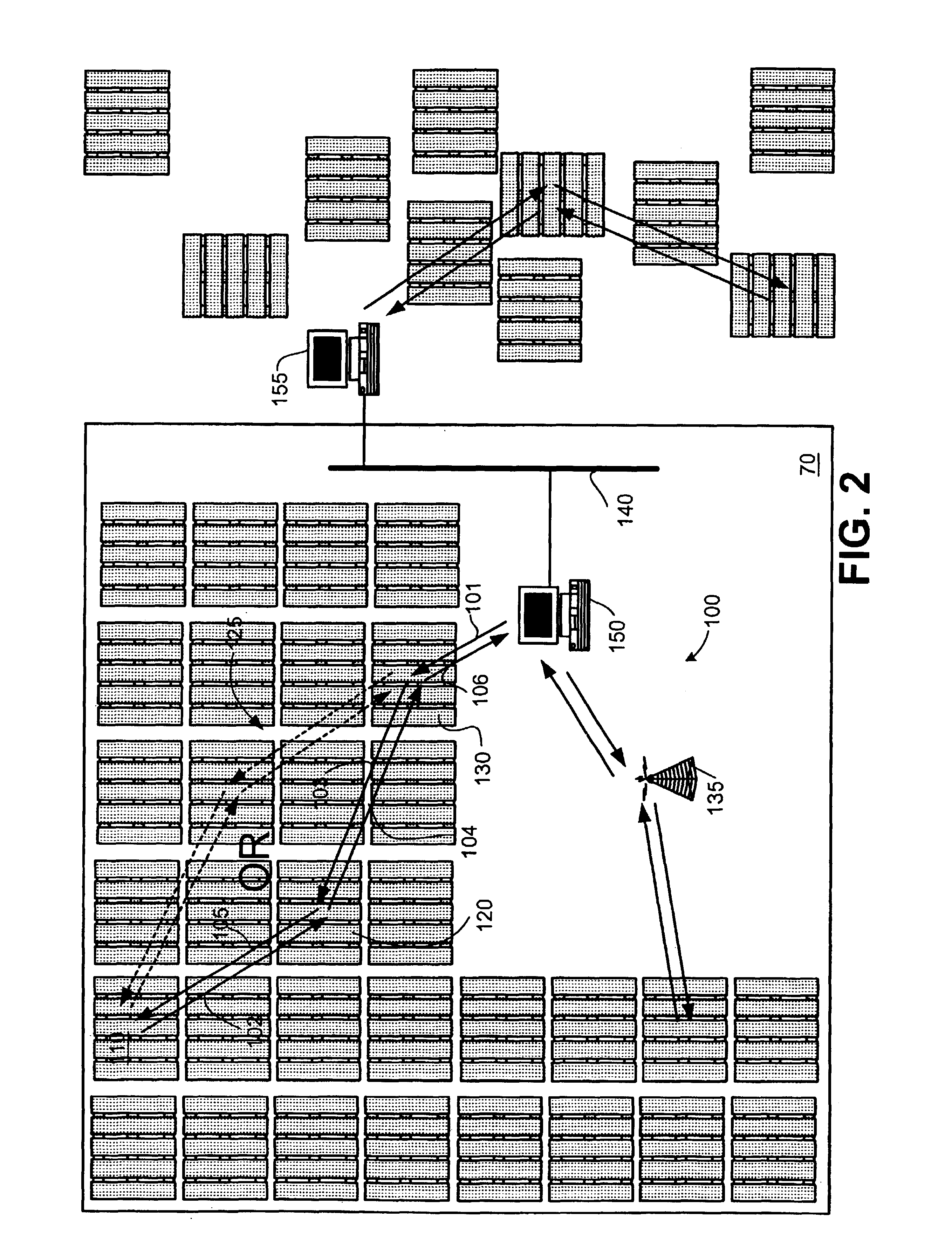

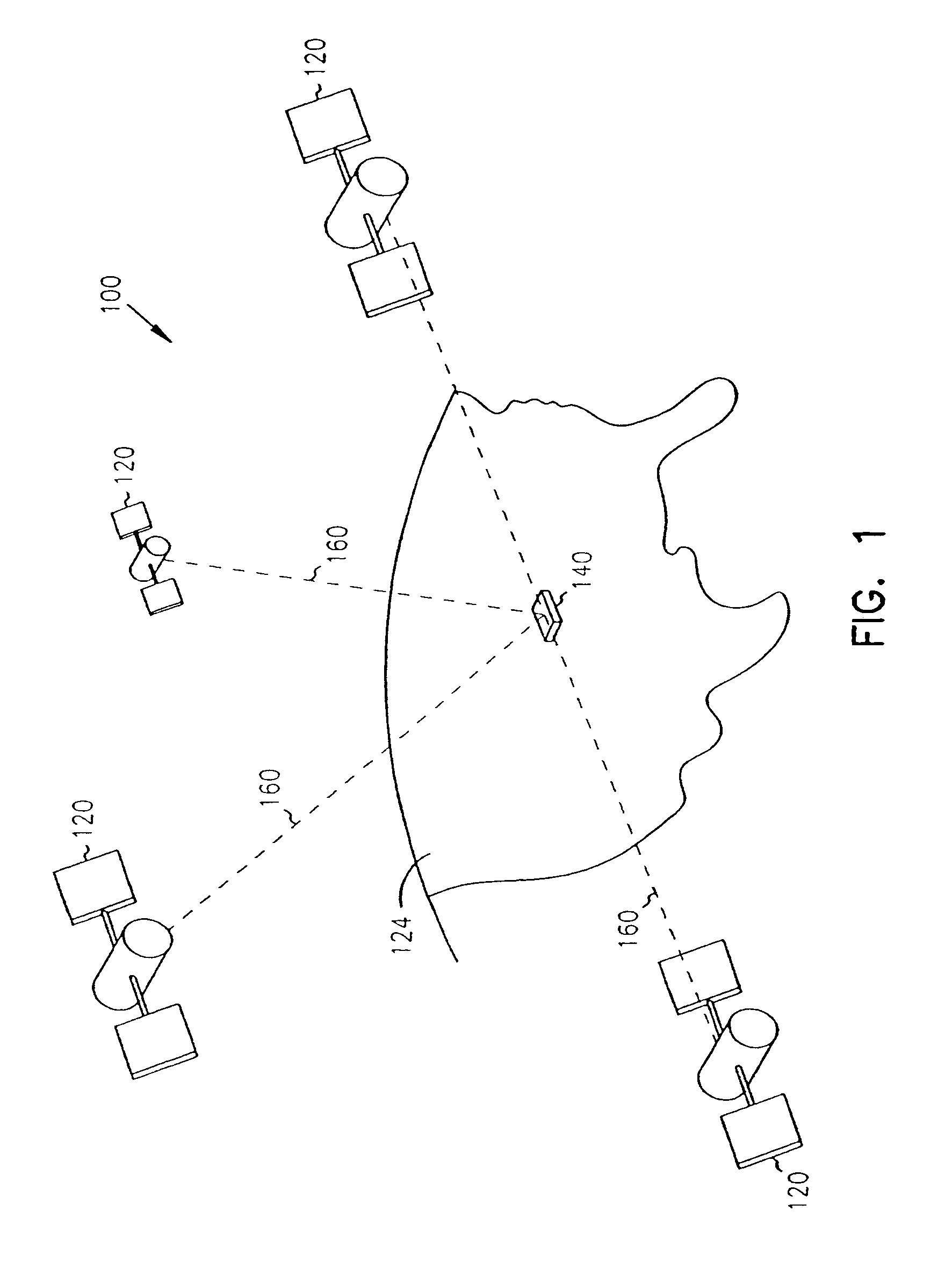

Monitoring and tracking of assets by utilizing wireless communications

InactiveUS6972682B2Minimal requirementFrequency-division multiplex detailsDigital data processing detailsCommunications systemComputer science

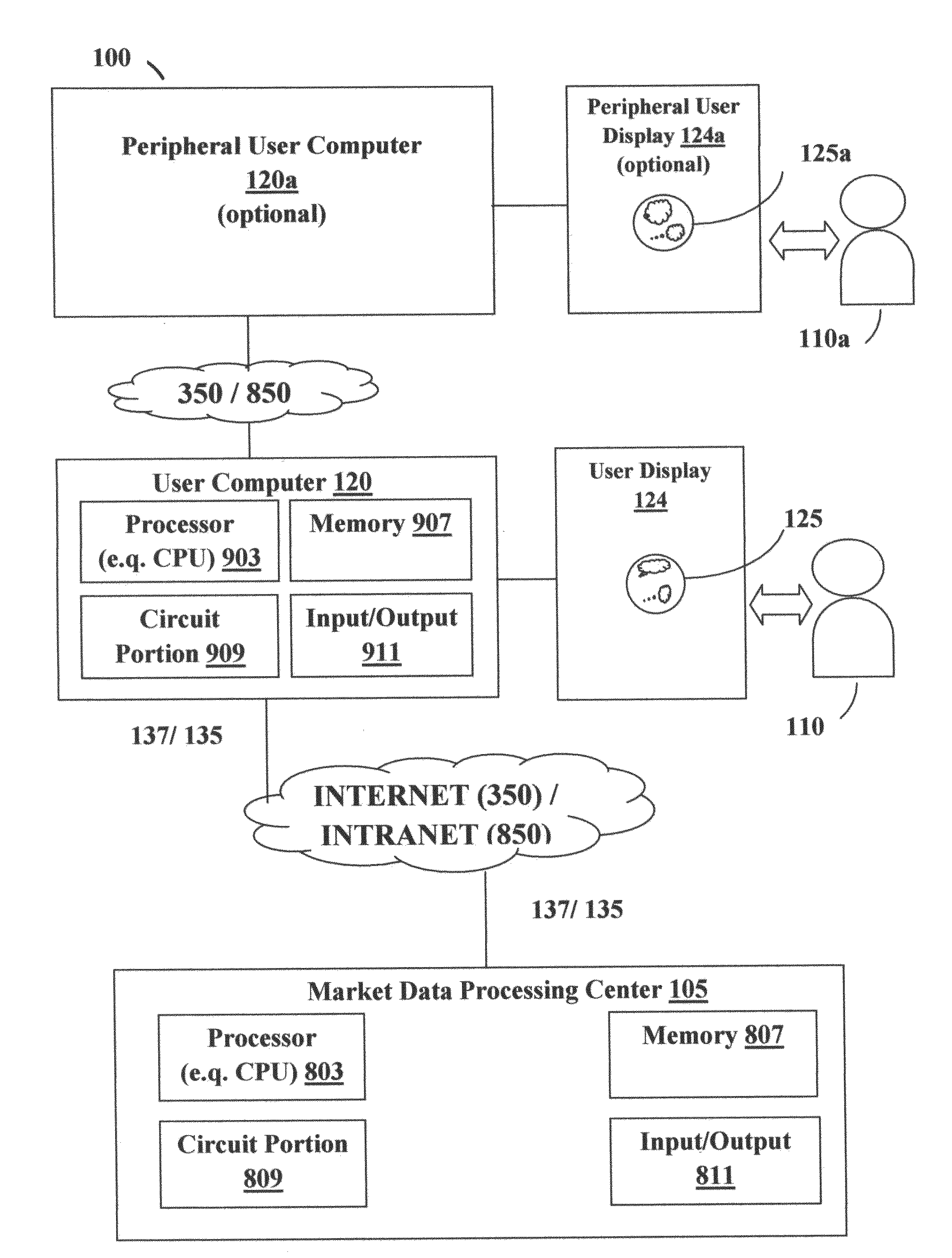

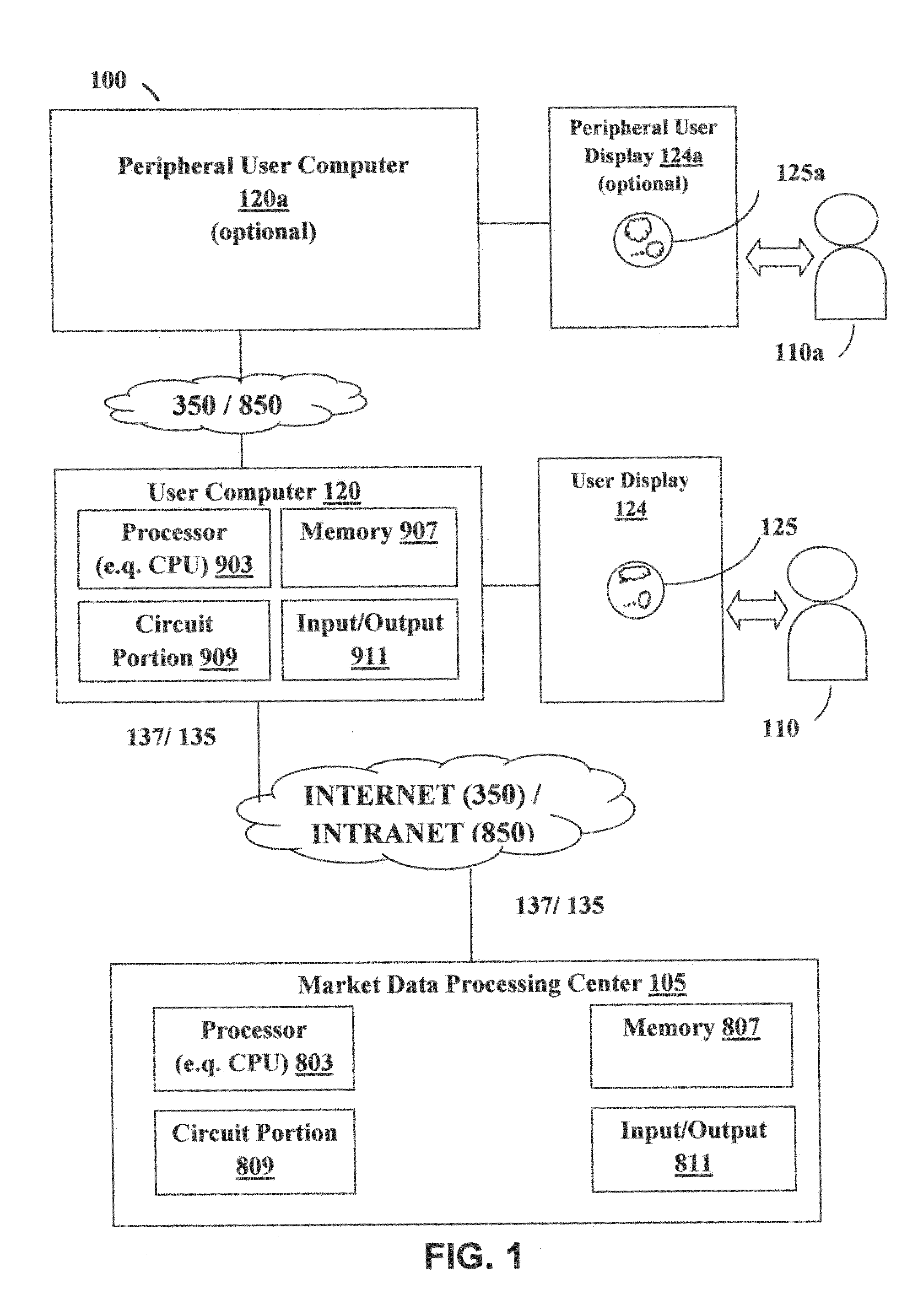

Systems, devices, methods, and programs disclosed herein provide a solution for monitoring and tracking assets by utilizing wireless communications. A representative system for monitoring assets includes a remote monitoring station (RMS) and a network of identification (ID) tags. Each ID tag is coupled to an asset and is configured to wirelessly communicate with other ID tags in the network within a predetermined proximity. Each tag is also configured to relay communications from other ID tags so that a communication path is established between the RMS and any ID tag in the network, either directly or via other ID tags.

Owner:GEORGIA TECH RES CORP

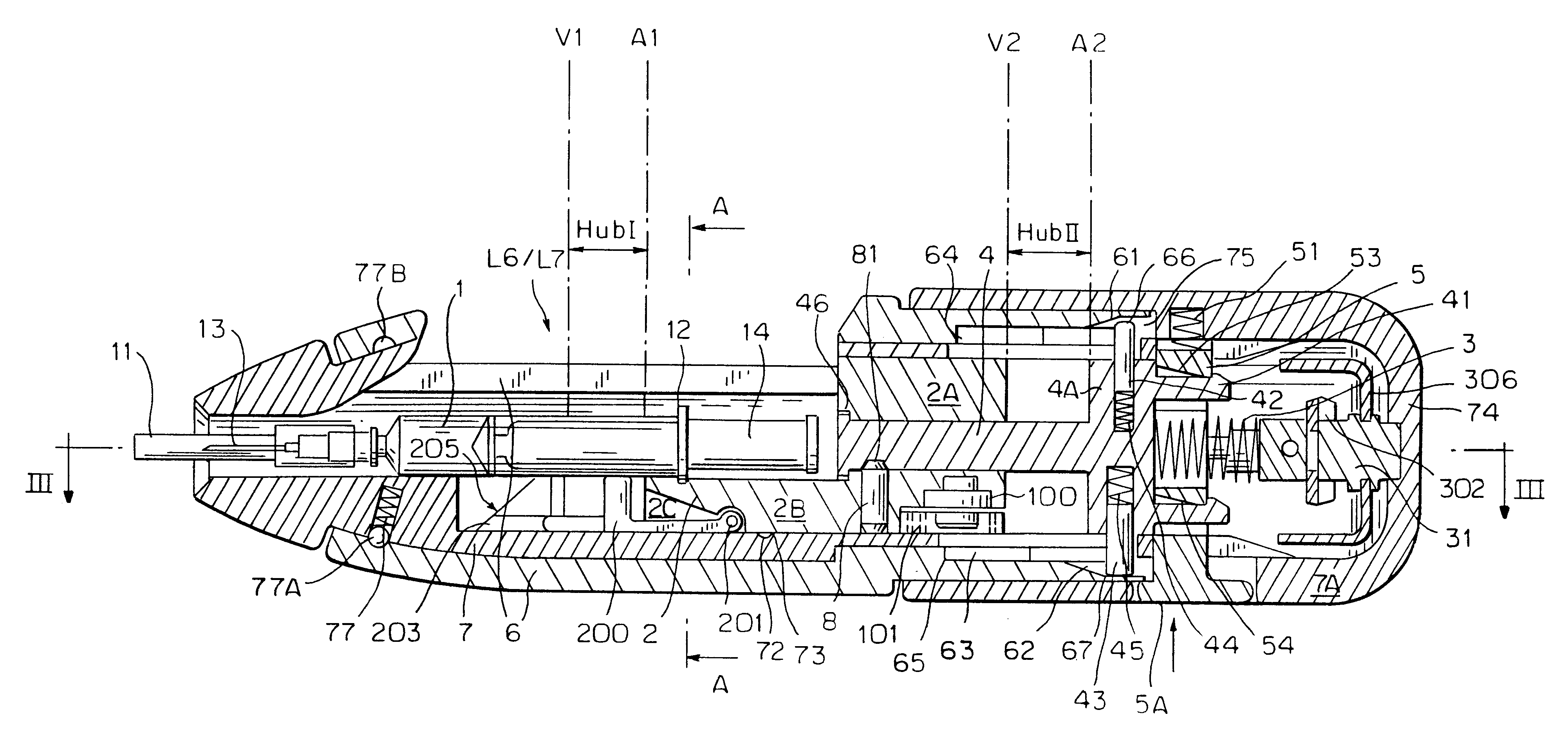

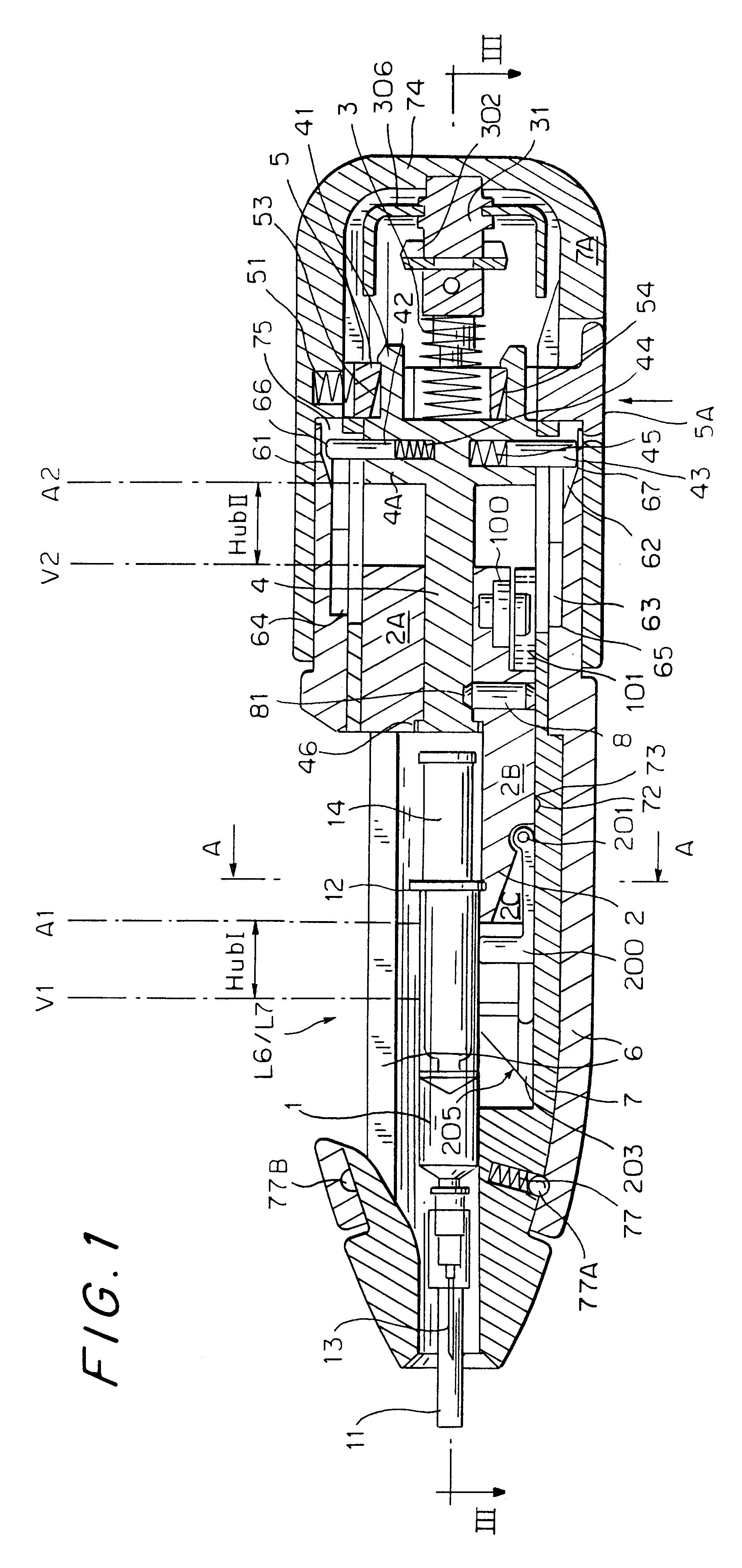

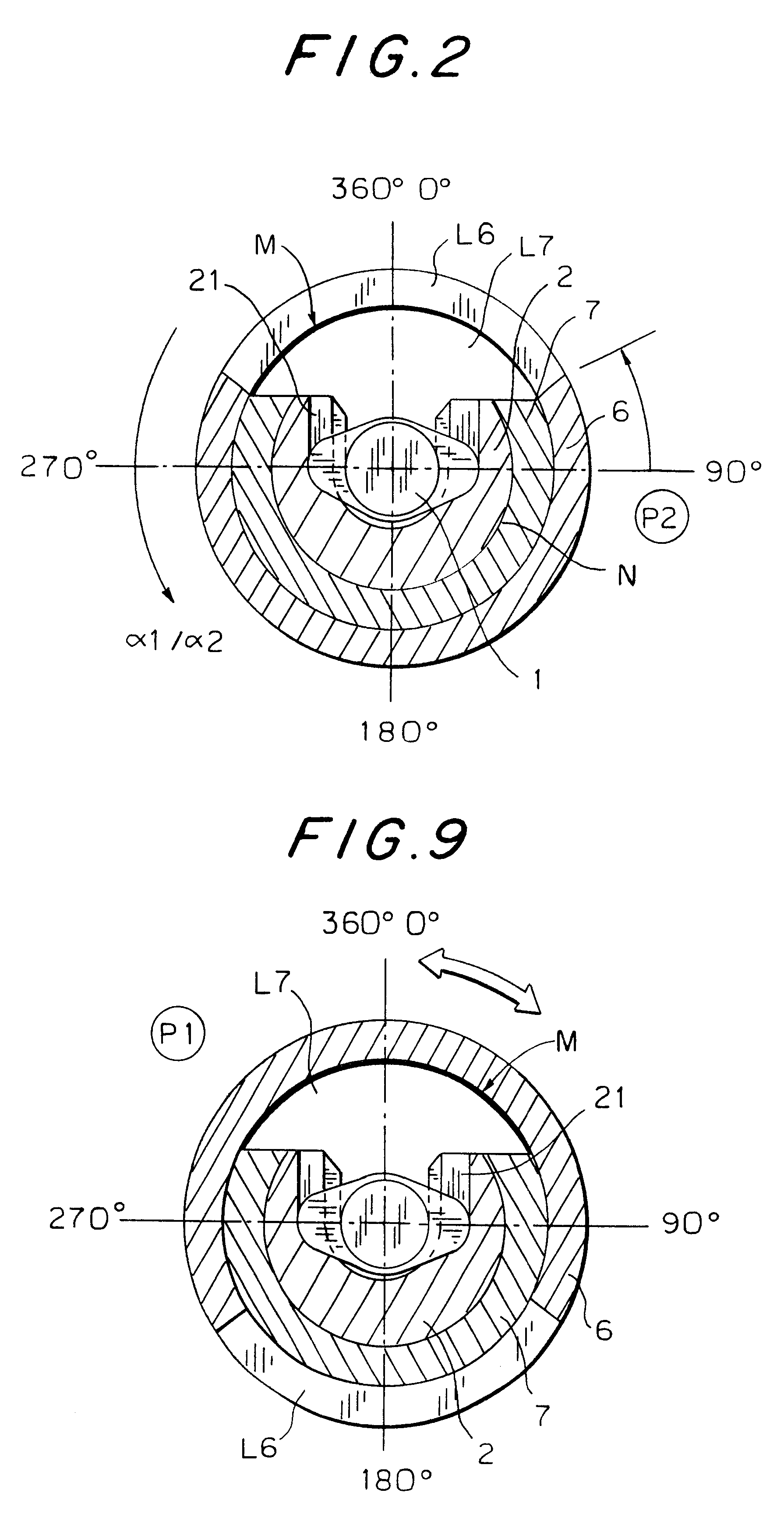

Injection device

InactiveUS6454743B1Simplify mechanical designMinimal requirementAutomatic syringesMedical devicesEngineeringBiomedical engineering

An injection device that is used with a syringe, wherein the injection needle of the syringe is initially introduced into the skin and the injection fluid is injected afterwards. The injection device is essentially driven and controlled by a control sleeve (6) which can be displaced and / or rotated in relation to the housing (7) and which can be moved between a closing and functional position (P1) and an open and safety position (P2). In the closing and functional position, the control sleeve prevents access to the syringe and activates a release device for the injection process. In the open and safety position, a syringe (1) can be removed or inserted. A plurality of components carrying out the injection process (a slide (2) in which the syringe (1) is placed and a plunger (4) that impinges upon the syringe piston) are moved or controlled depending on the movement and position of the control sleeve or supported (for example, an ejection device for the syringe or a signaling device informing that injection has been completed). The device enables full-automatic injection that can be reliably carried out by patients themselves with few handling procedures.

Owner:BAYER INTELLECTUAL PROPERTY GMBH

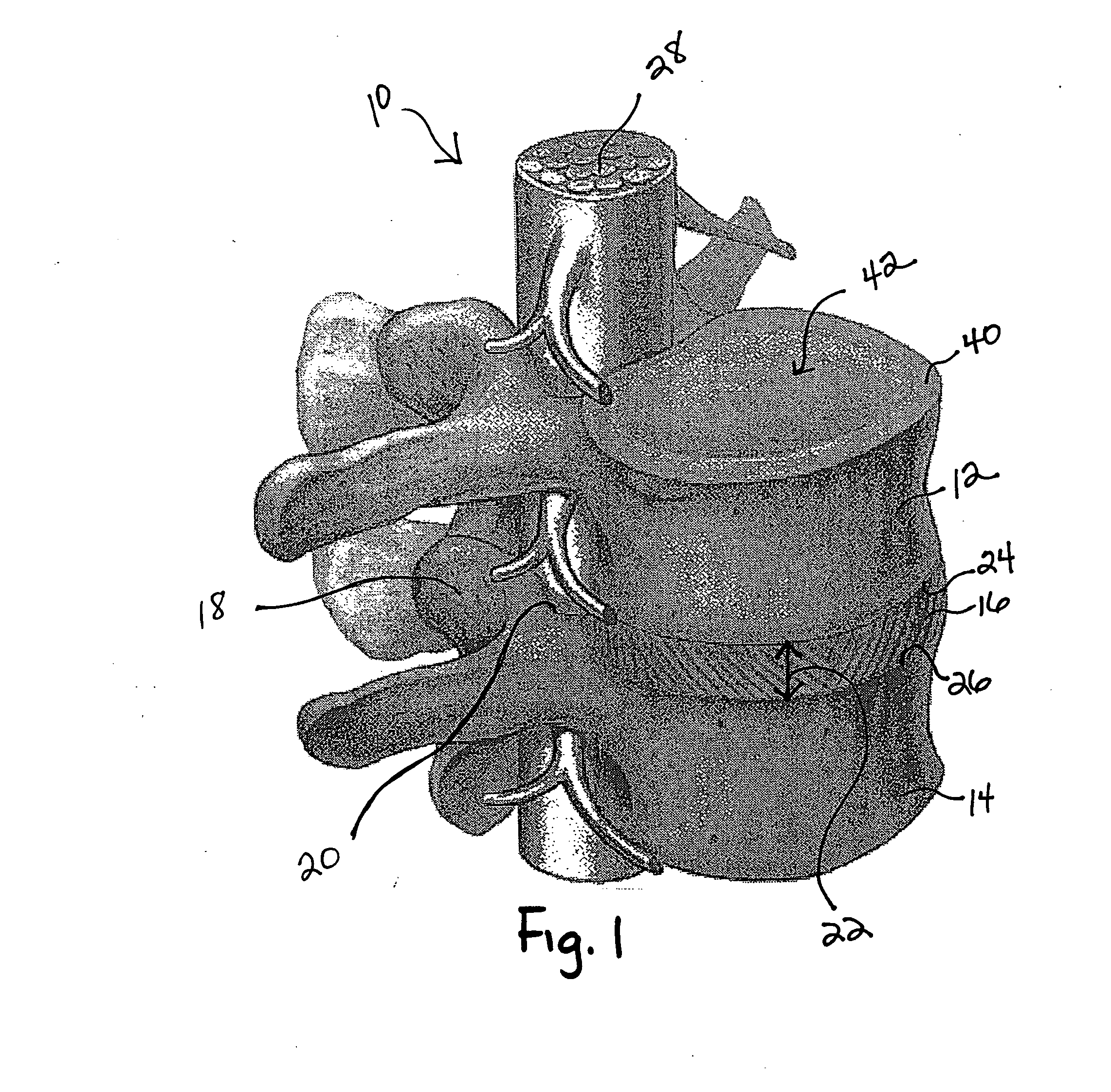

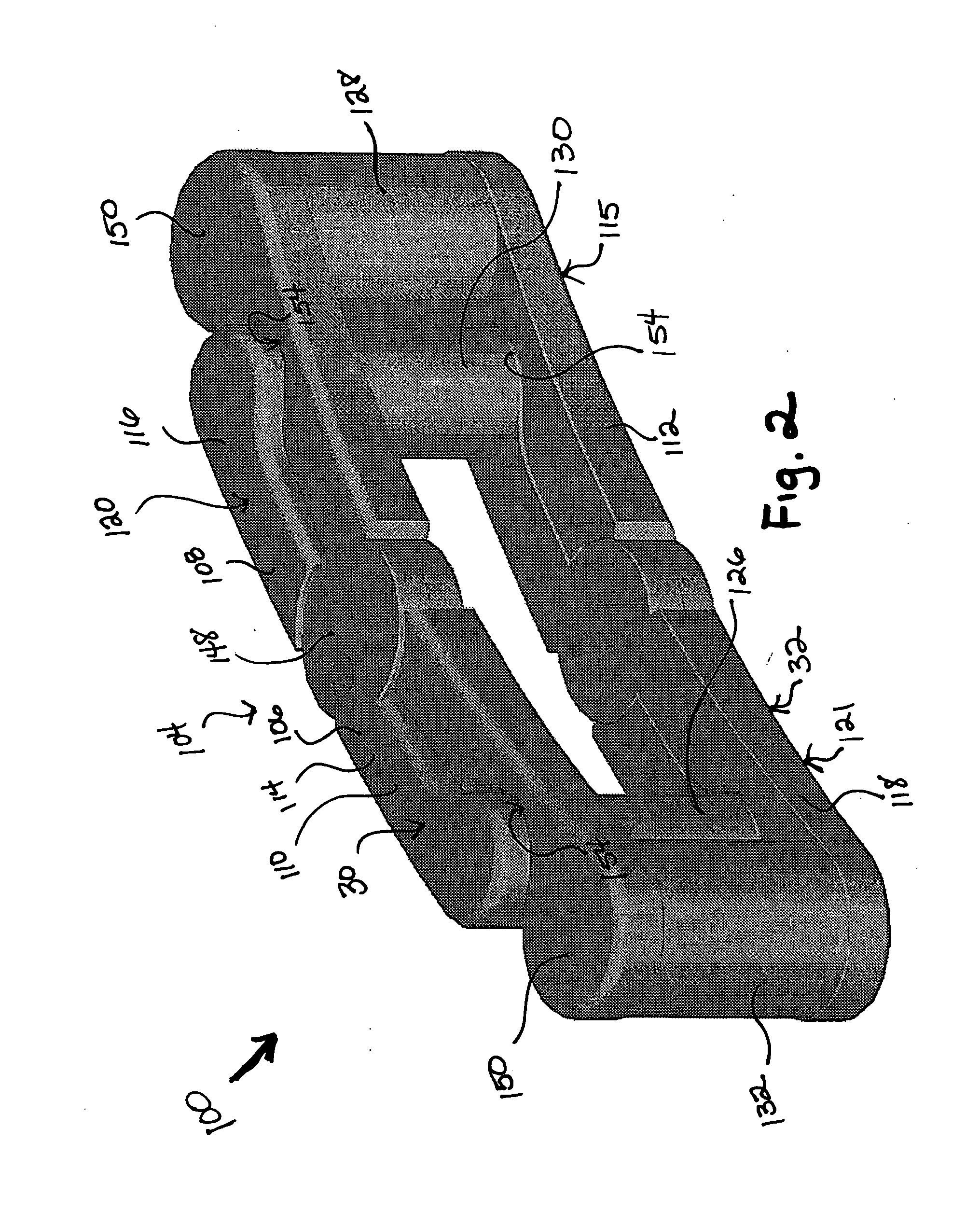

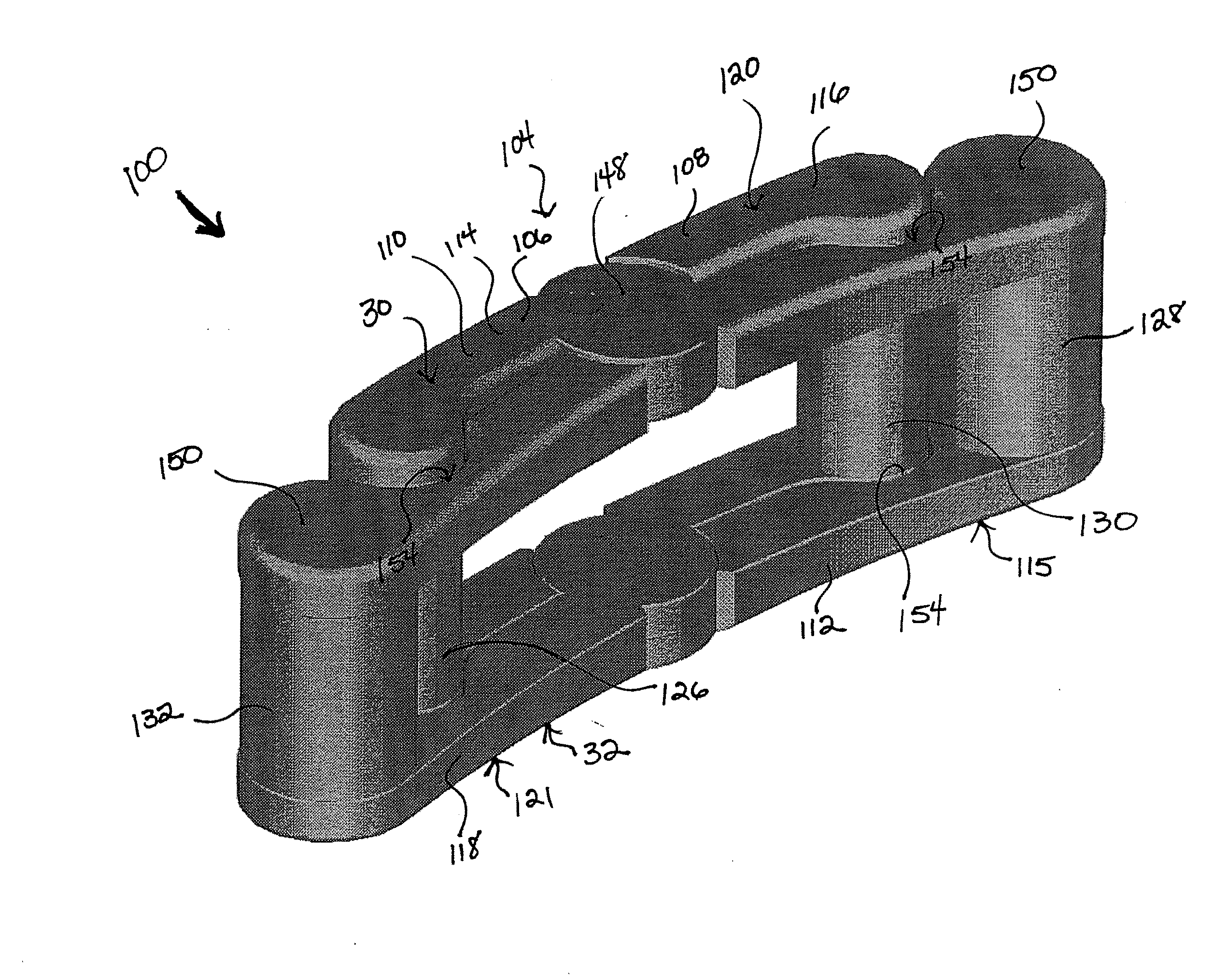

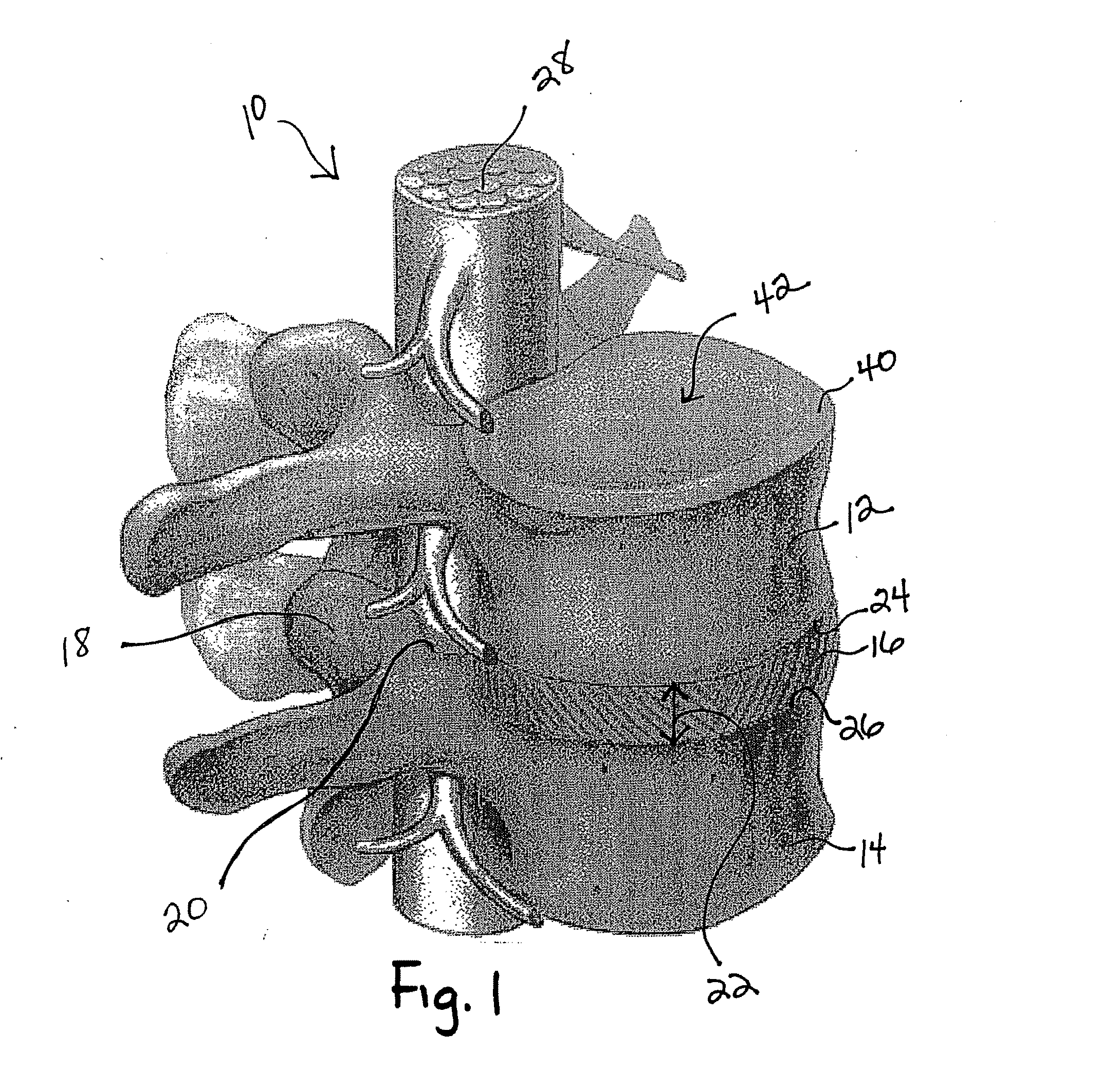

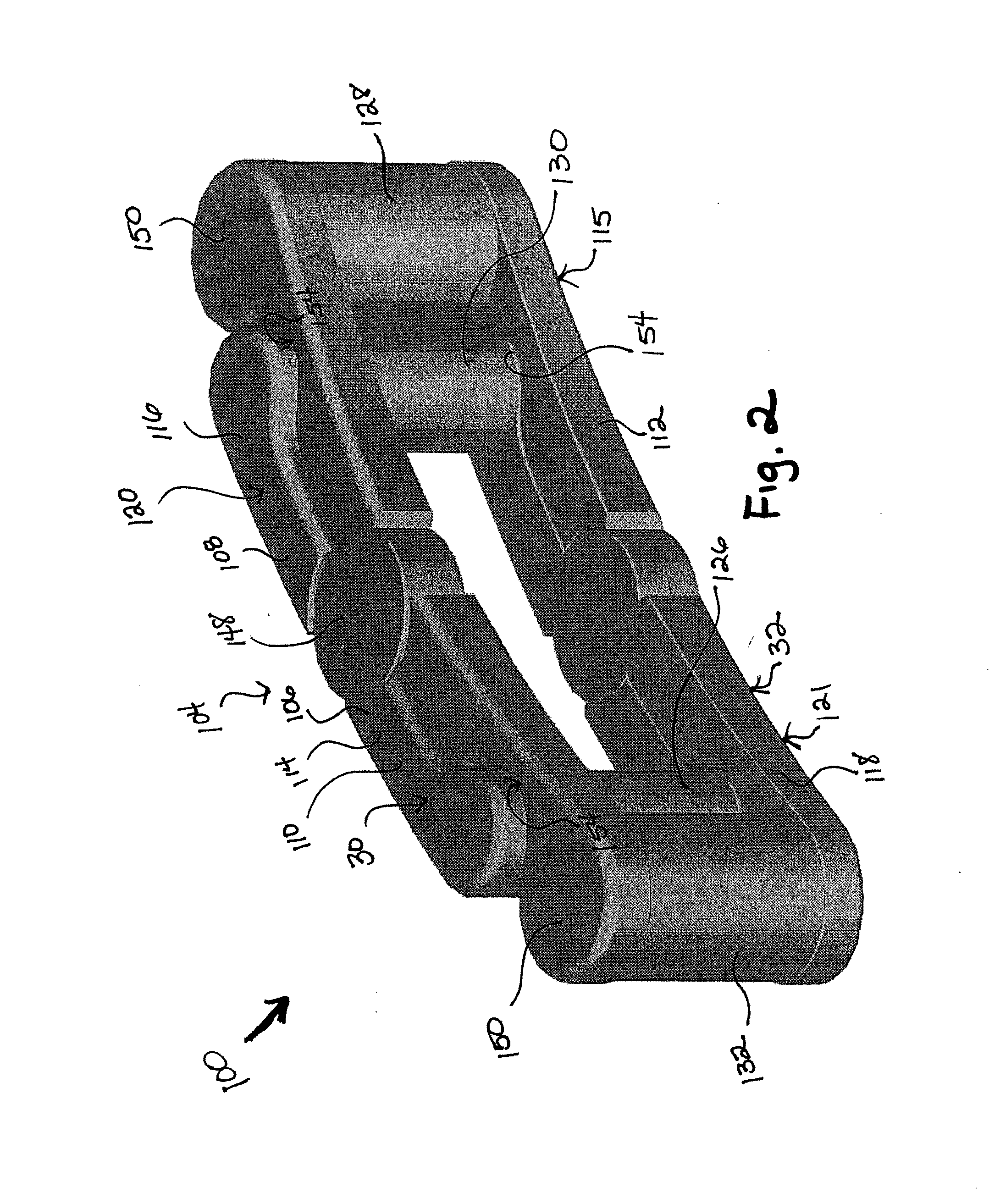

Spine surgery method and implant

ActiveUS20070073398A1Large effective footprint areaMinimal requirementBone implantSpinal implantsLamina terminalisIntervertebral disk

An implant has a first contact surface to contact a first vertebral body endplate and a second contact surface to contact a second vertebral body endplate adjacent the first vertebral body. The implant is deployable, when positioned within an intradiscal space between the first and second vertebral bodies, from a first non-expanded condition where the first contact surface has a first effective footprint area A1 to a second expanded condition where the first contact surface has a second effective footprint area A2. The ratio A2 / A1 is at least 1.05.

Owner:VERTEBRATION

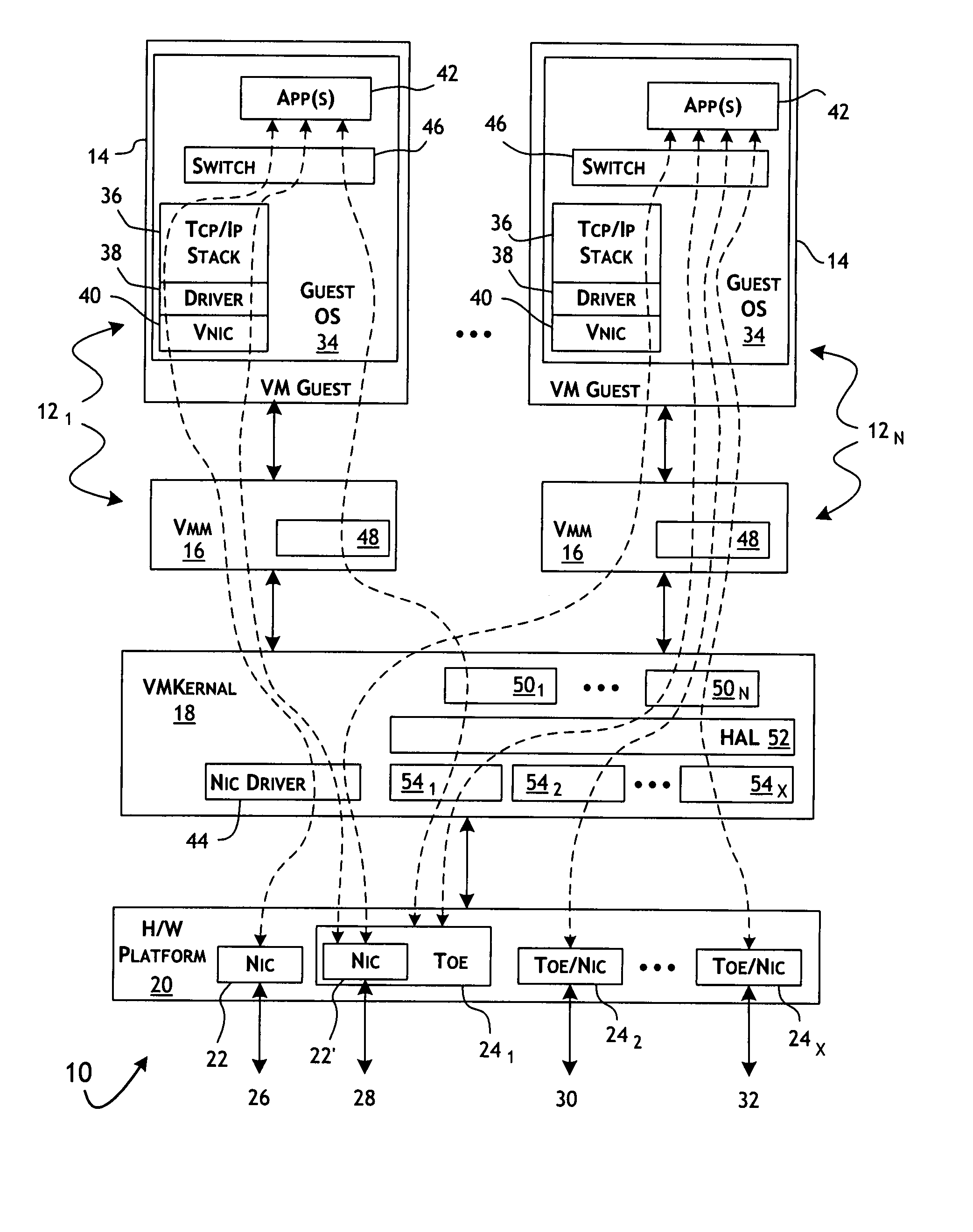

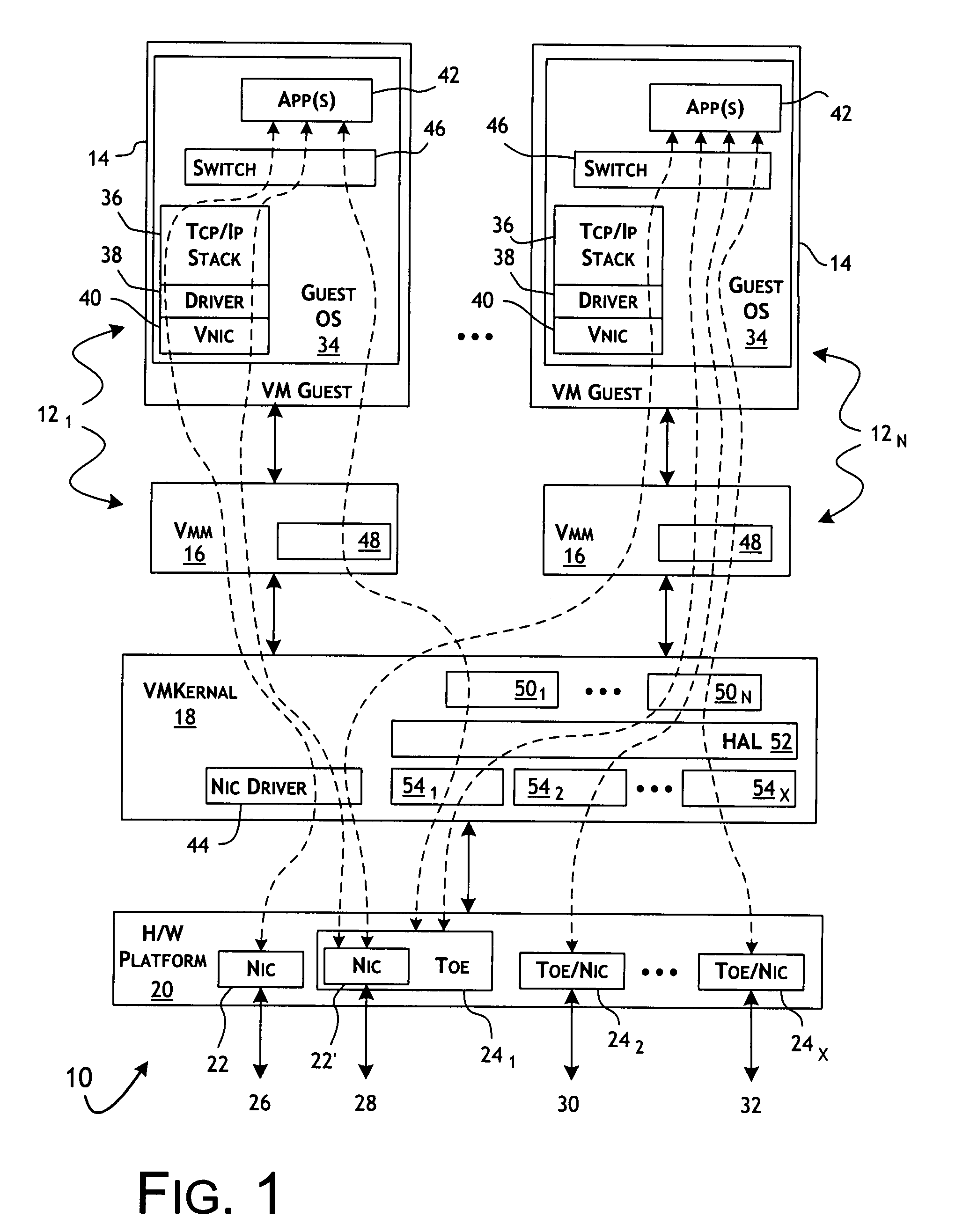

TCP/IP offload engine virtualization system and methods

ActiveUS8028071B1Utilize bandwidthEasy to optimizeData switching by path configurationMultiple digital computer combinationsVirtualizationNetworking protocol

A virtual computer system enabling dynamic, aggregated use of multiple TCP / IP offload engines (TOEs) by the set of guest computer systems hosted on the virtual computer system. Each of the guest computer systems includes an offload selection switch and the associated virtual machine monitor includes a first virtual context component. Second virtual context components are associated with a set of TCP / IP stacks and TOEs and interoperate with the first virtual context components to establish a virtual routing of network connections between the offload selection switches and the TOEs. The virtual context mapping retains the initially requested network connection information as well as the resolved virtual network connection established, thereby allowing the initial network connection request to be internally reapplied as required to accommodate dynamic changes in the network protocol parameters of the TOEs.

Owner:VMWARE INC

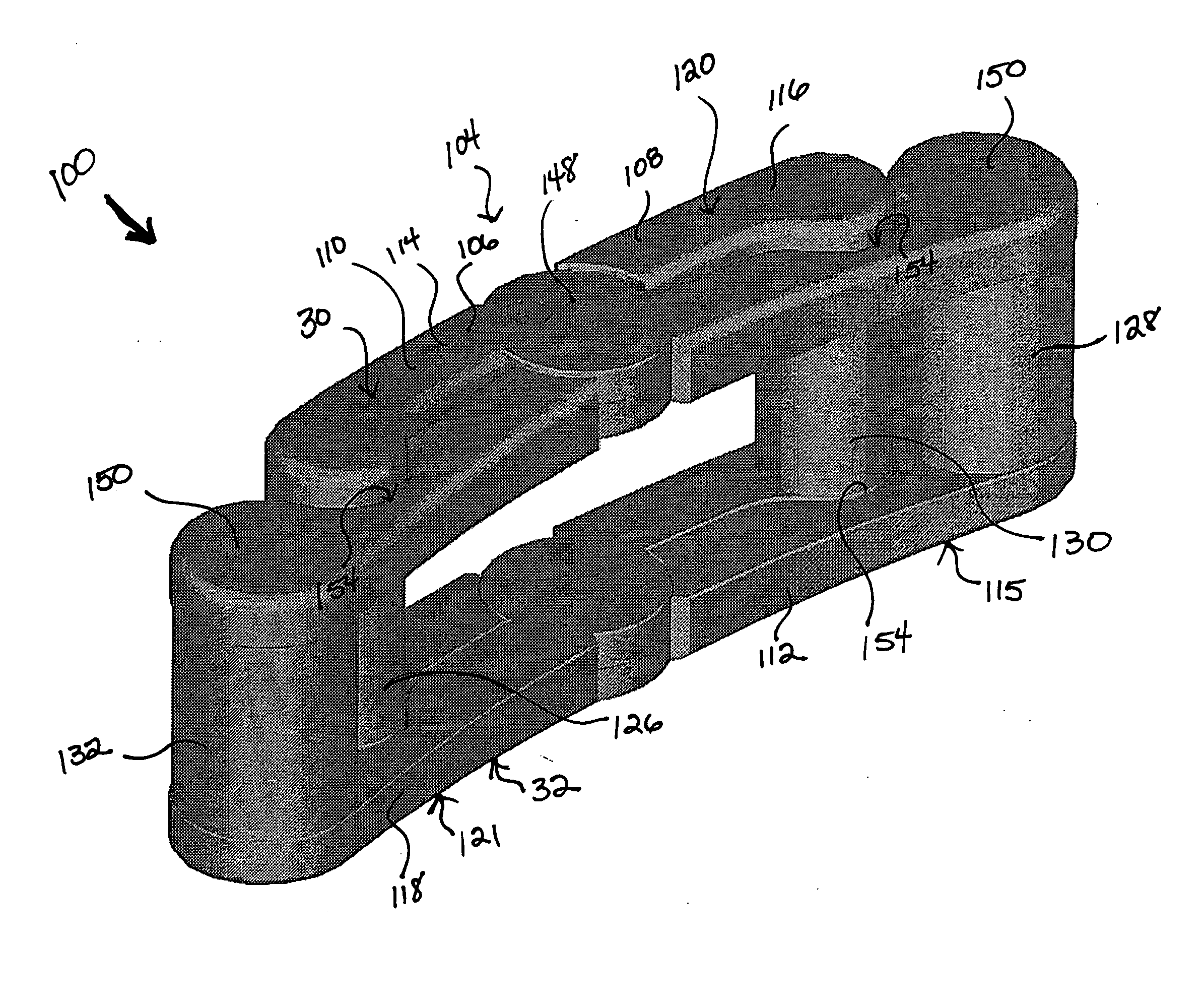

Spine surgery method and implant

ActiveUS20130310939A1Maximizing boney ingrowth surface areaMaximizing bone graft-host contactBone implantSpinal implantsBiomedical engineeringSpine surgery

An implant has a first contact surface to contact a first vertebral body endplate and a second contact surface to contact a second vertebral body endplate adjacent the first vertebral body. The implant is deployable, when positioned within an intradiscal space between the first and second vertebral bodies, from a first non-expanded condition where the first contact surface has a first effective footprint area A1 to a second expanded condition where the first contact surface has a second effective footprint area A2. The ratio A2 / A1 is at least 1.05.

Owner:FABIAN HENRY F +1

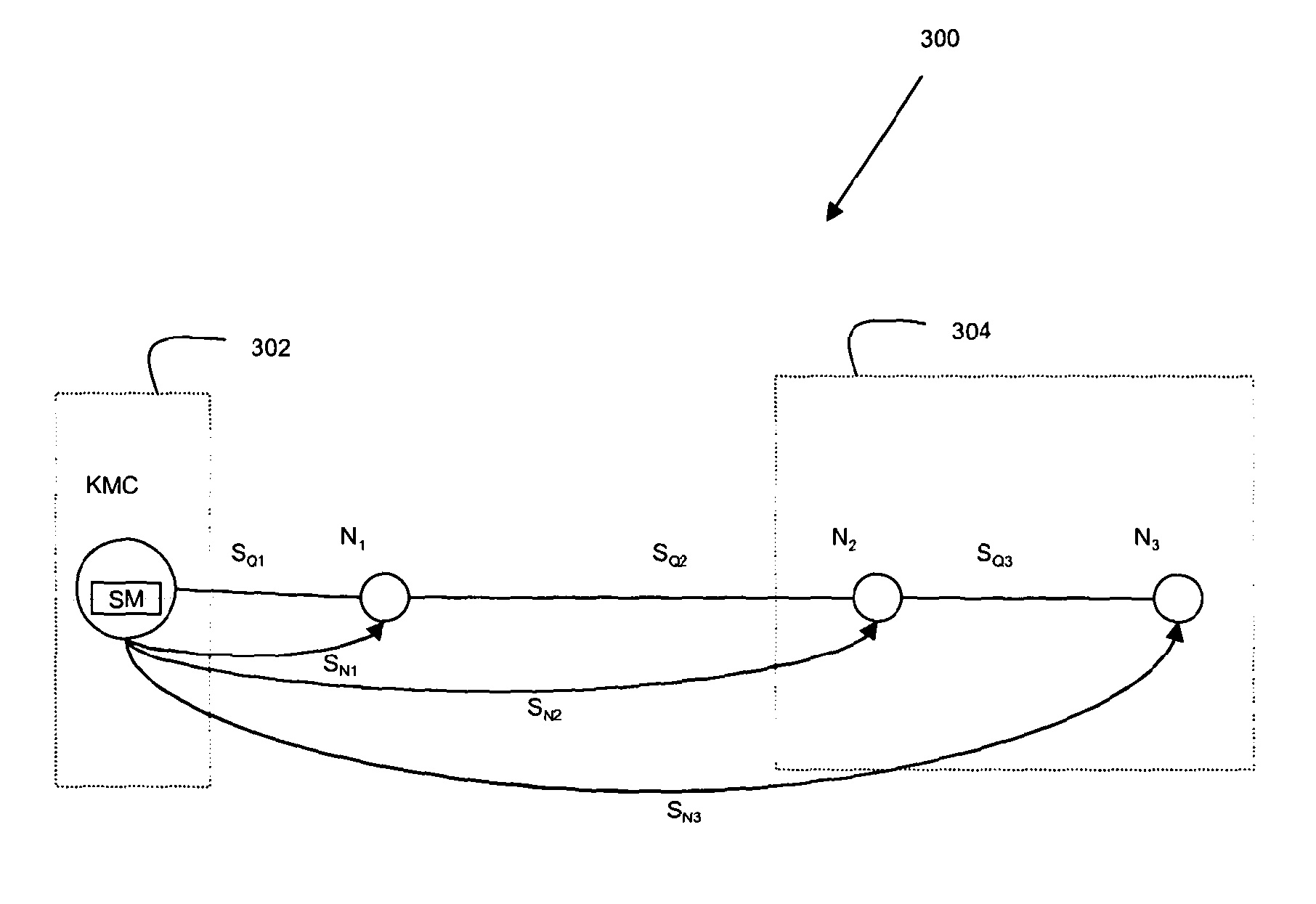

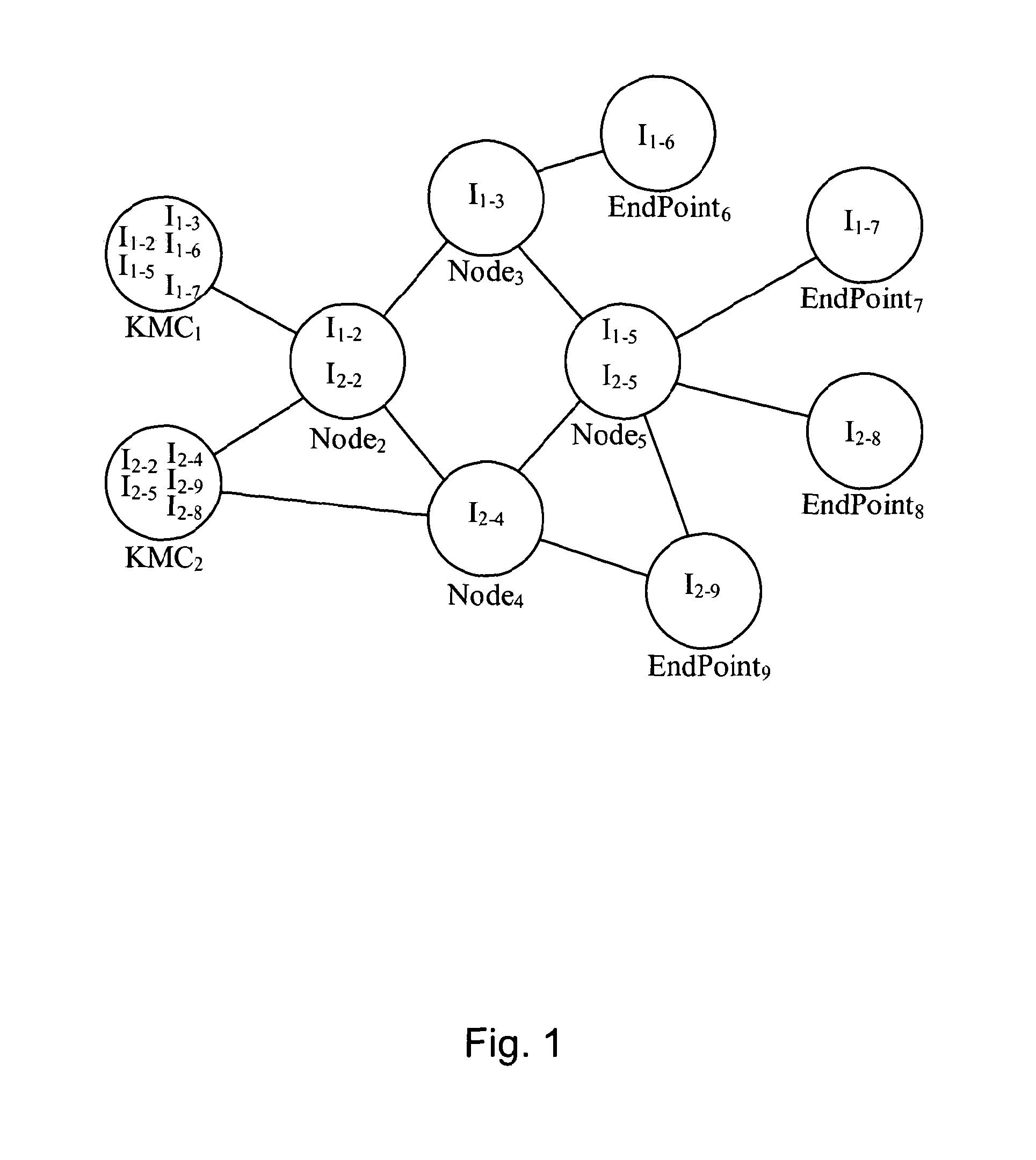

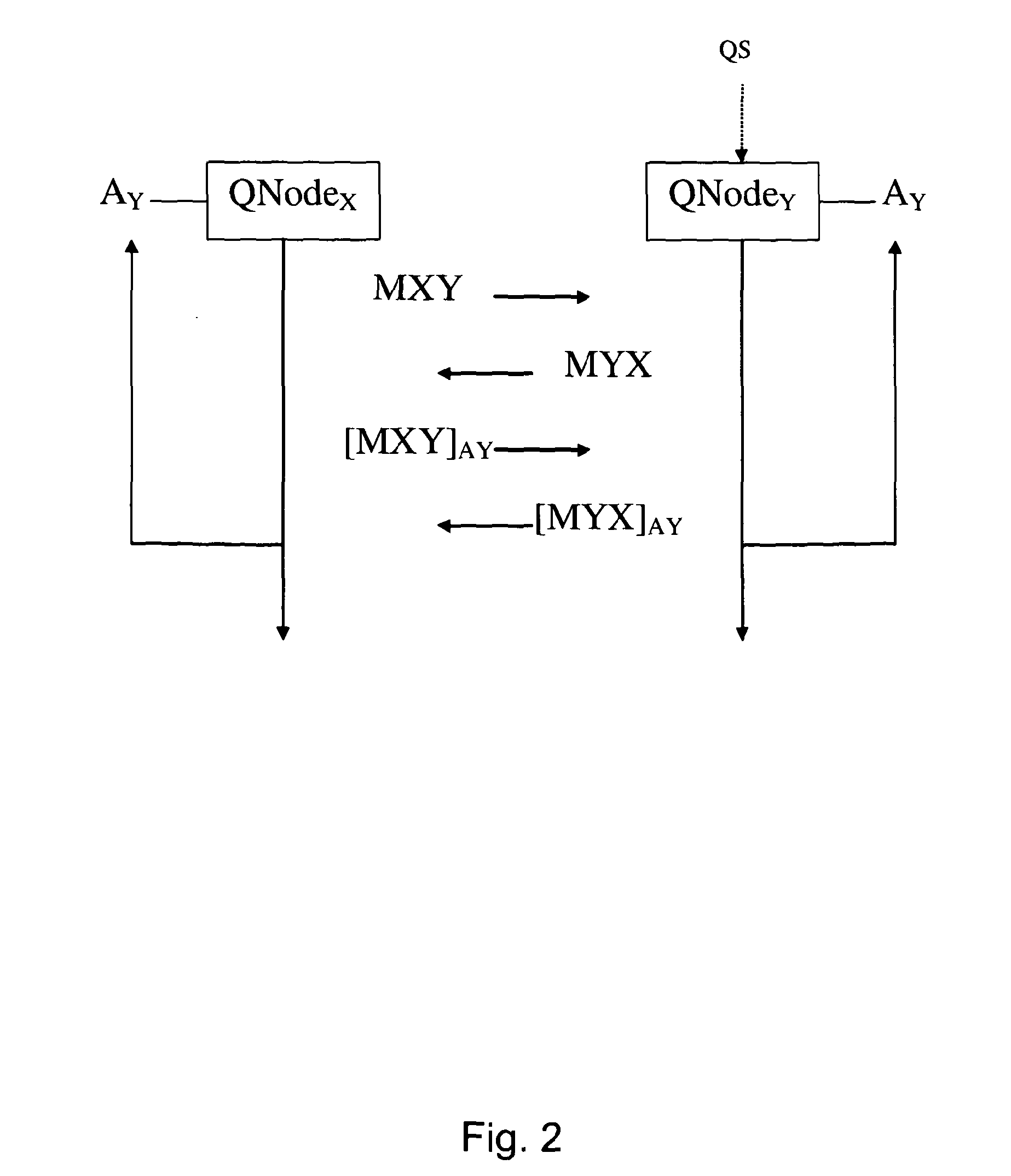

Quantum key distribution

ActiveUS20130251145A1Improve network securityIncrease ratingsKey distribution for secure communicationKey distributionQuantum key distribution

Methods and apparatus for quantum key distribution are described, in particular including methods and networks 300 arranged to improve and / or ensure the security of data transmitted thereby by (i) ensuring a certain level of loss within at least part of the network, (ii) placing a penultimate and an endpoint nodes in situated in a secure second enclave, (iii) analysing a transmitted bit stream to ensure that it does not provide an unacceptable amount of information about the key that may be generated therefrom, and / or (iv) varying the order in which bits are used to generate a key.

Owner:QUBITEKK

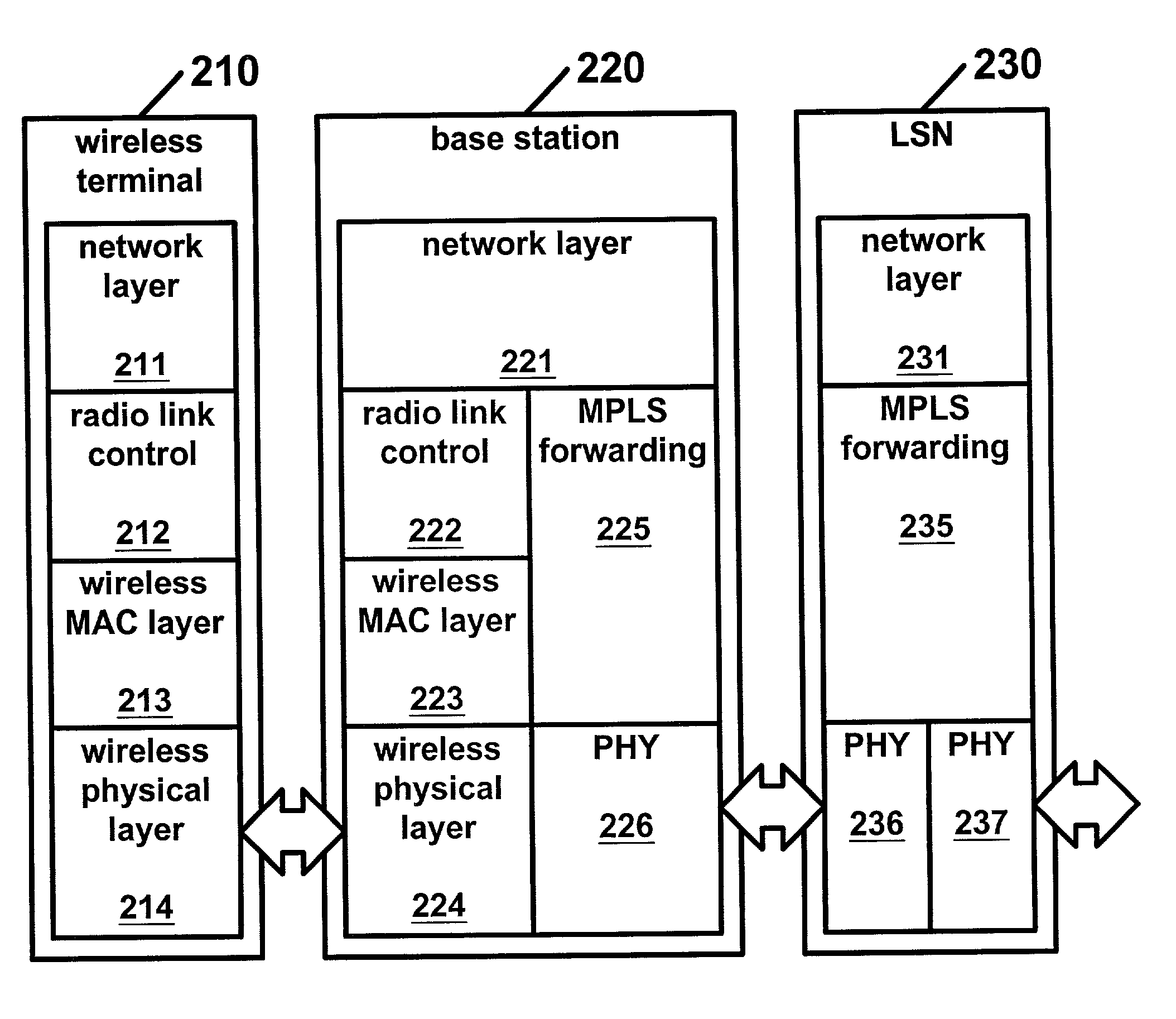

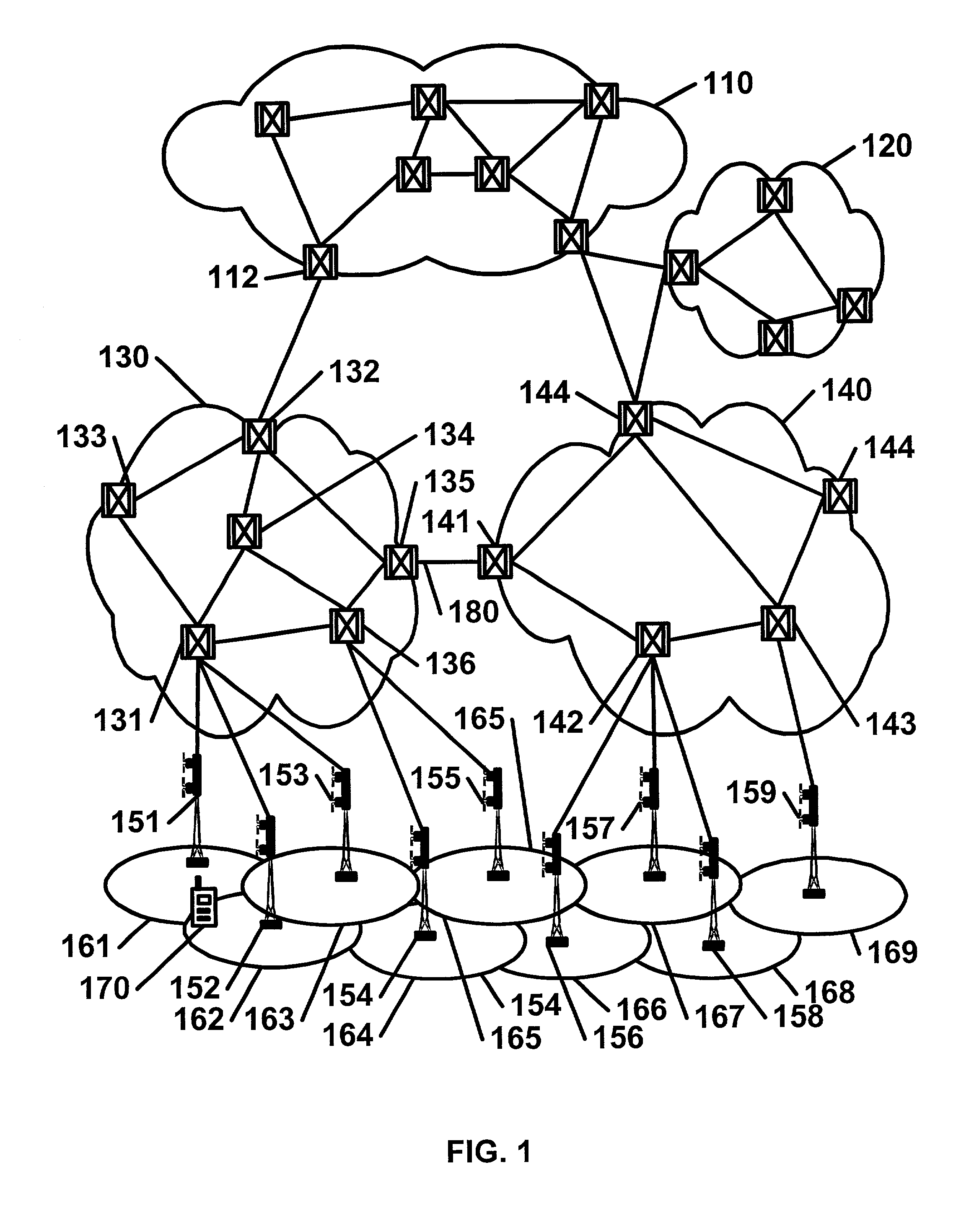

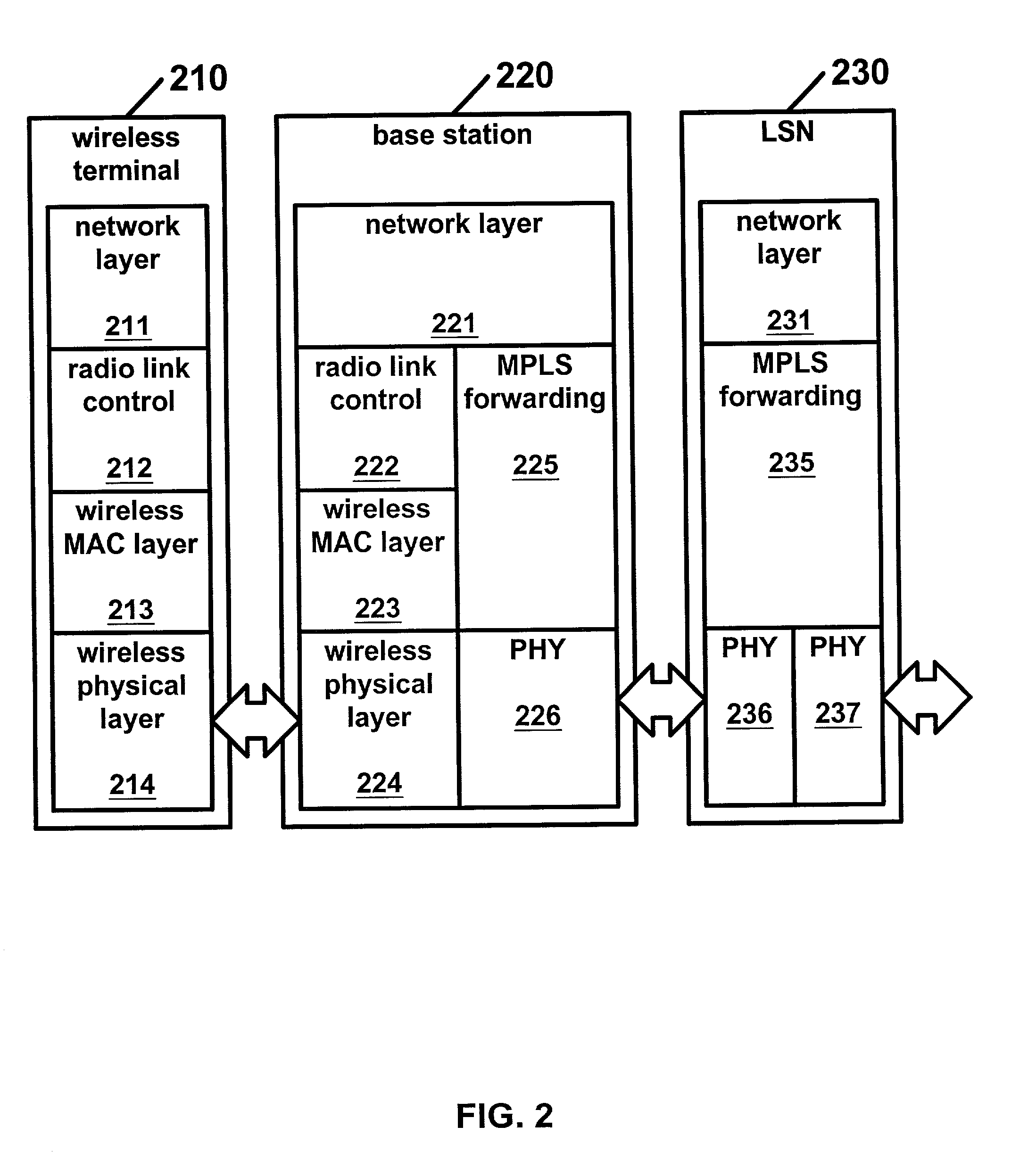

Wireless label switched packet transfer network

ActiveUS7061896B2Minimal requirementProvide benefitsNetwork traffic/resource managementNetwork topologiesWireless mesh networkMulti link

A method and apparatus to support a hierarchical architecture which integrates wireless mobile terminals into networks such as the Internet. This architecture provides for efficient packet transfers over mobile wireless networks by efficiently allocating wireless resources. Label Switched packet forwarding facilitates traffic engineering and internetworking by attaching short fixed length labels to communications packets at an entry node to a wireless network to provide an efficient path to an exit node of the same wireless network. Forwarding mechanisms and limited broadcasting of reachability information are used in managing and routing the communications packets through the wireless mobile network. The present invention also supports multiple radio links between a mobile and a multiplicity of base stations. Multi-link techniques are used to affect an efficient packet transfer and admission policy.

Owner:RPX CORP

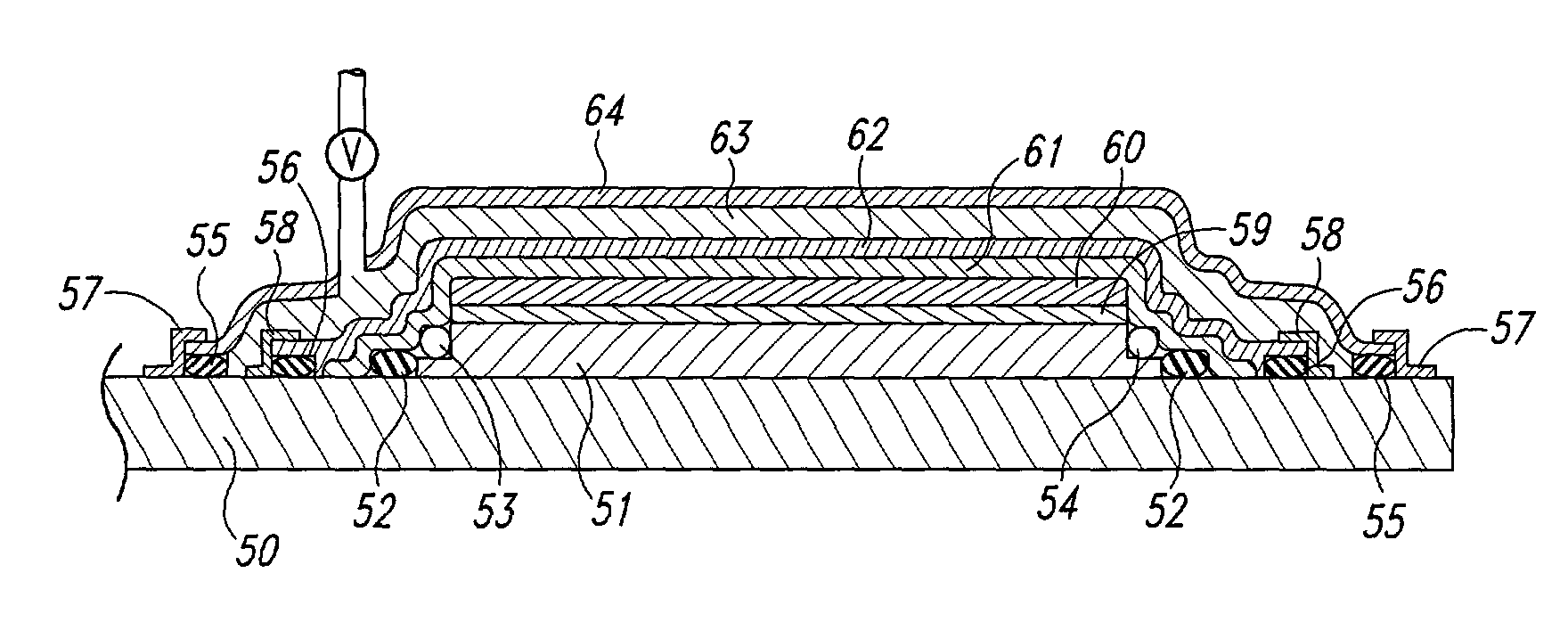

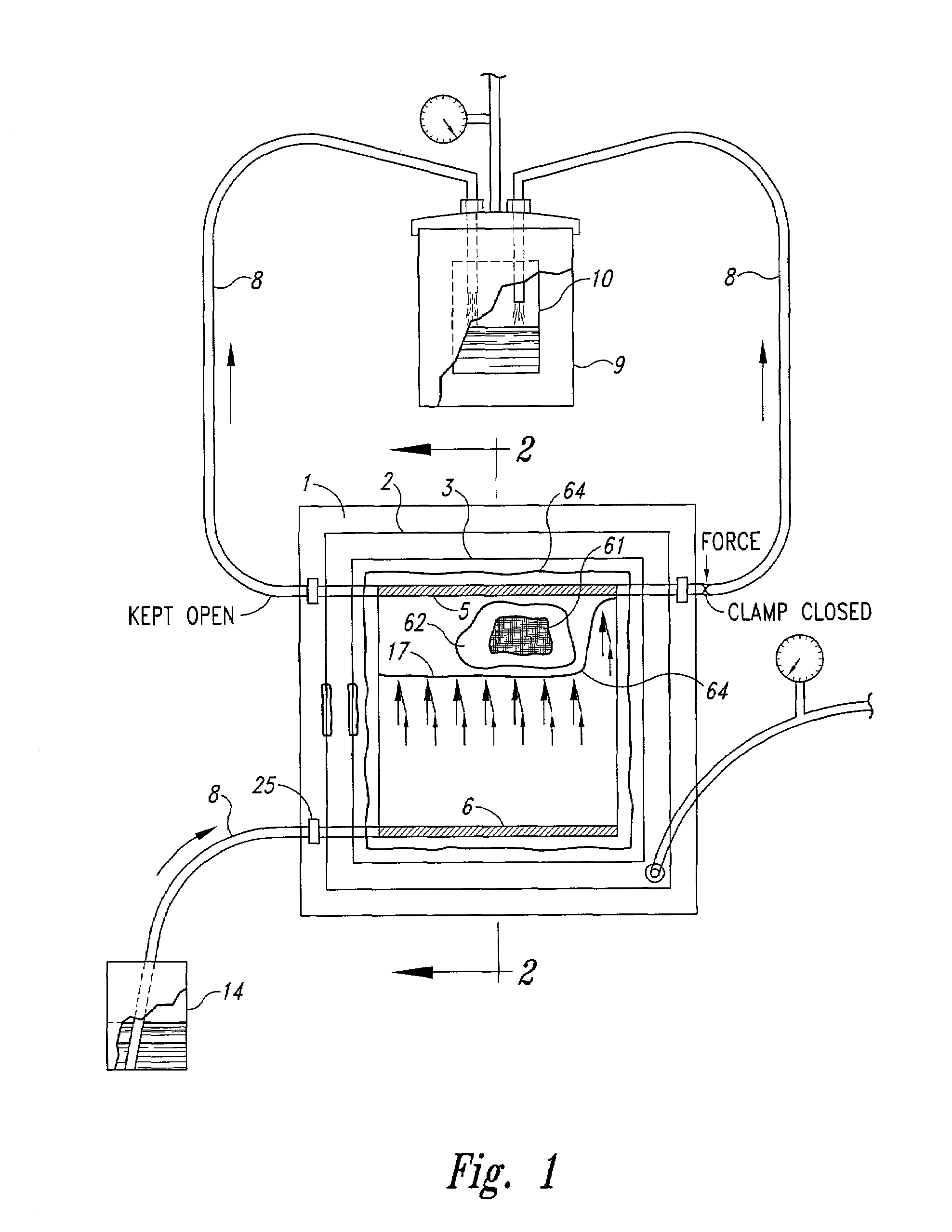

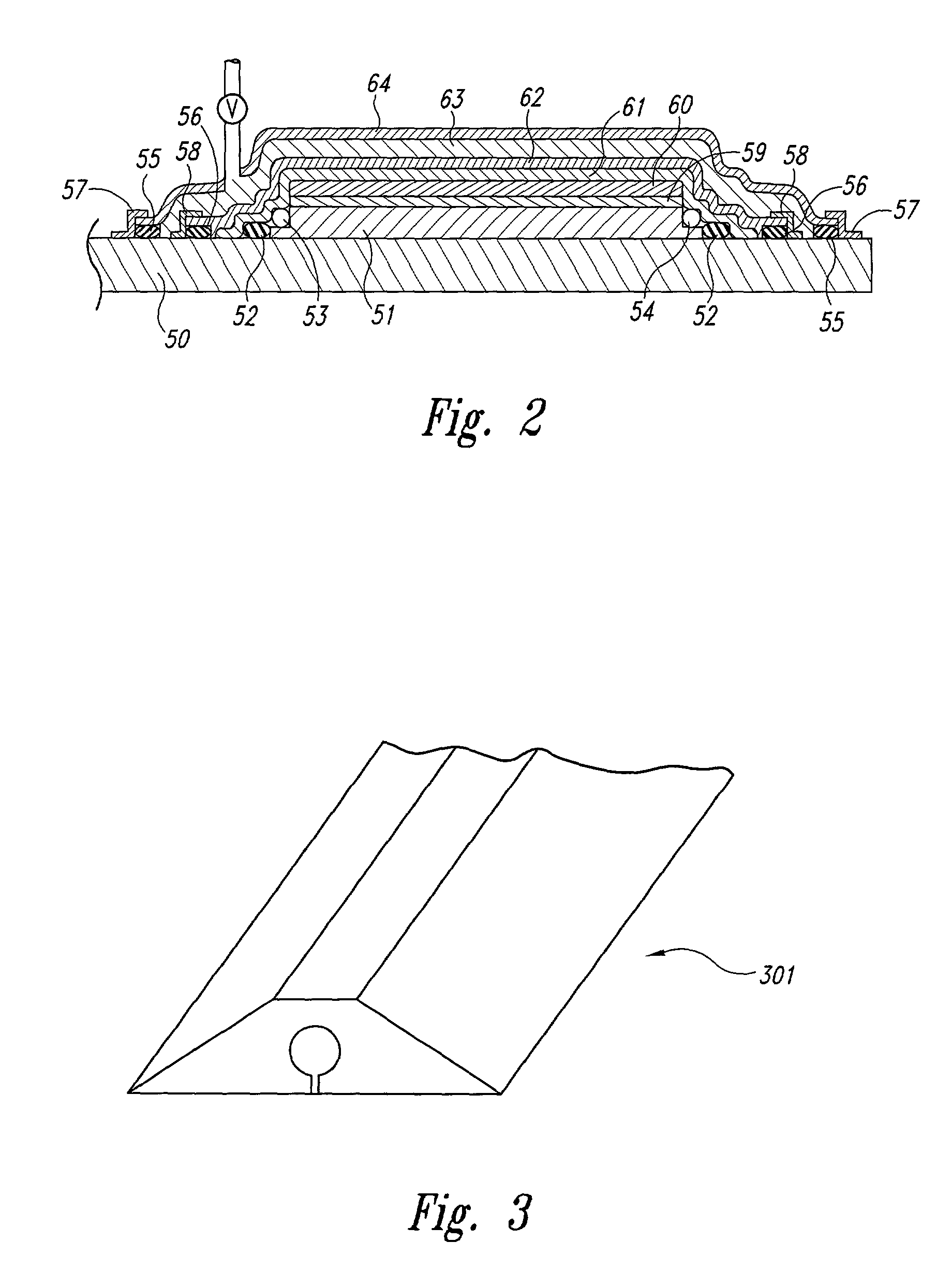

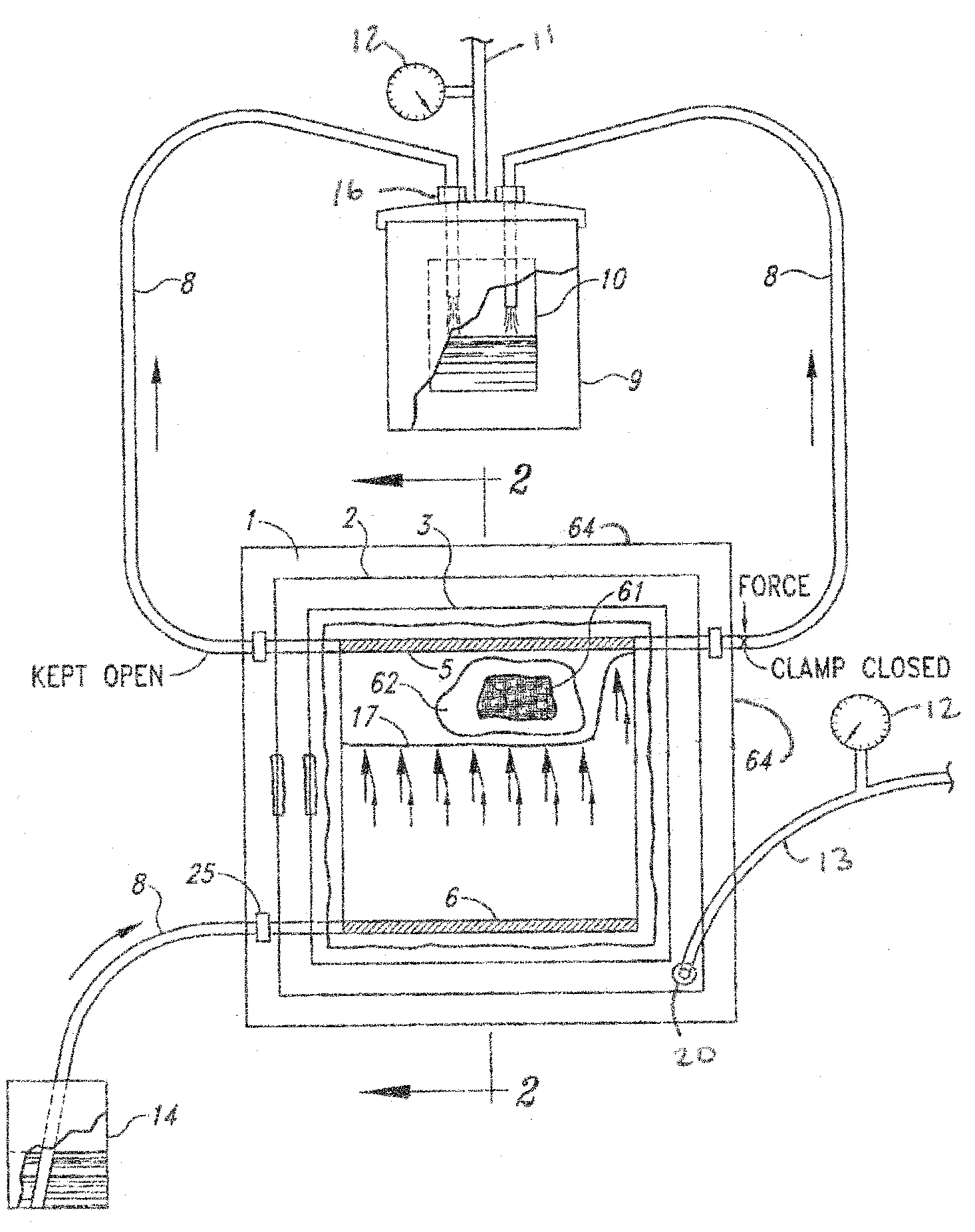

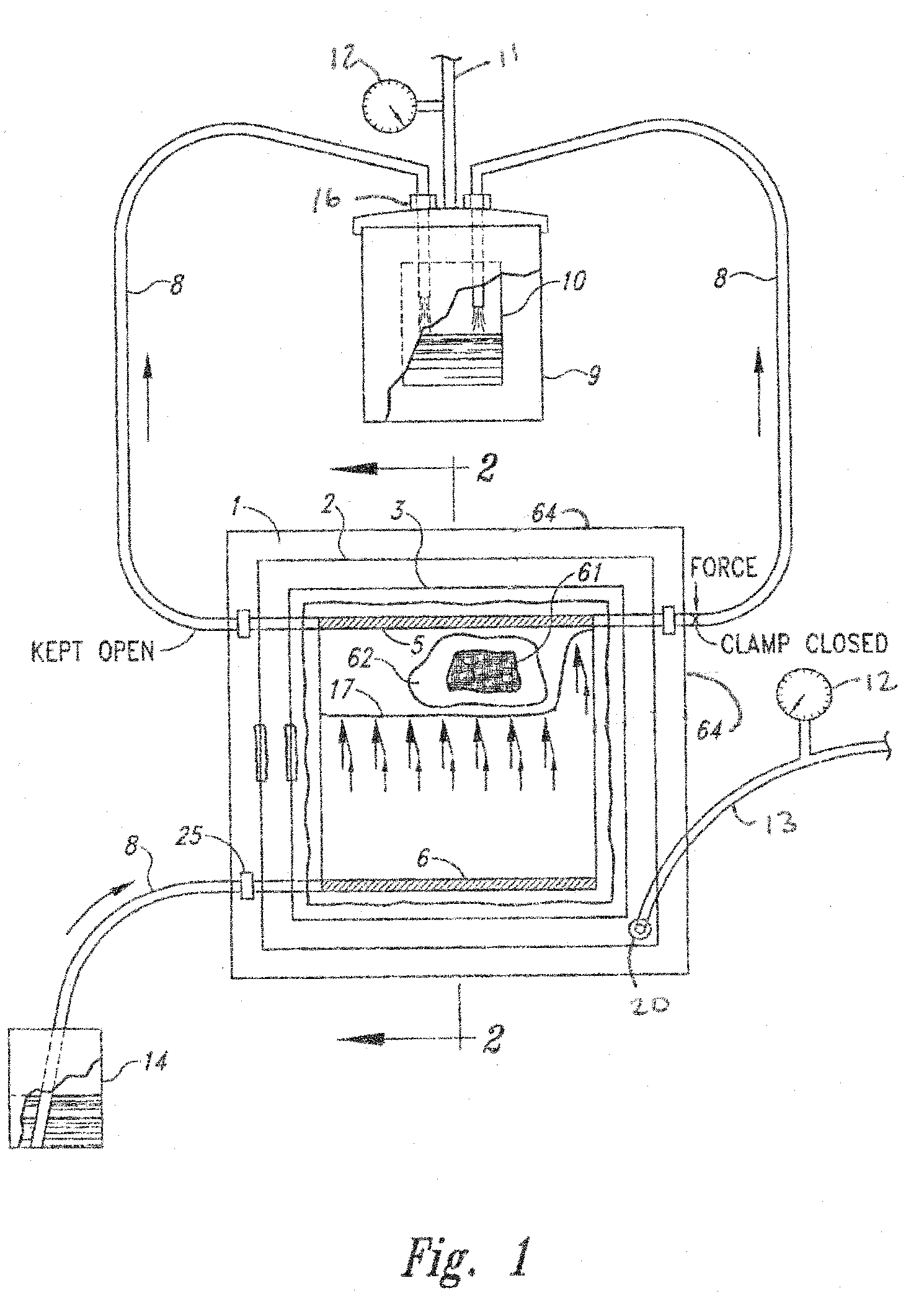

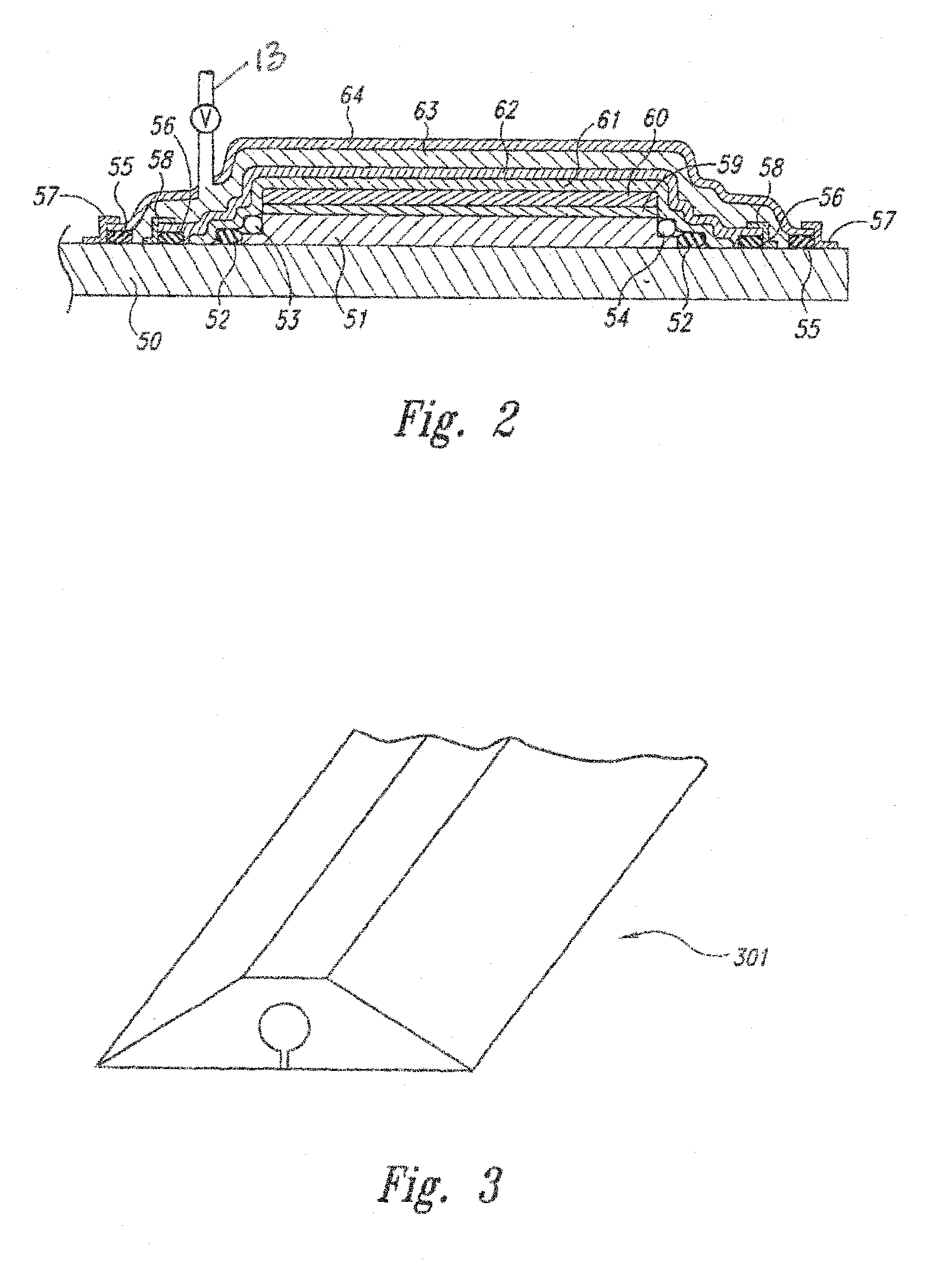

Double bag vacuum infusion process

InactiveUS7413694B2Reduce porosityMinimal surface porositySynthetic resin layered productsLaminationMedia controlsFiber

The double bag vacuum infusion process of the present invention provides a low cost method for producing complex composite assemblies without an autoclave. It also enables the production of highly innovative structures. The quality of the composites produced using such an infusion process are comparable to composites made using prepregs, hand layup or fiber placement, and autoclave curing. Double bagging provides vacuum integrity, controls bag relaxation while flow media controls the flow front to allow high quality aerospace-grade products.

Owner:THE BOEING CO

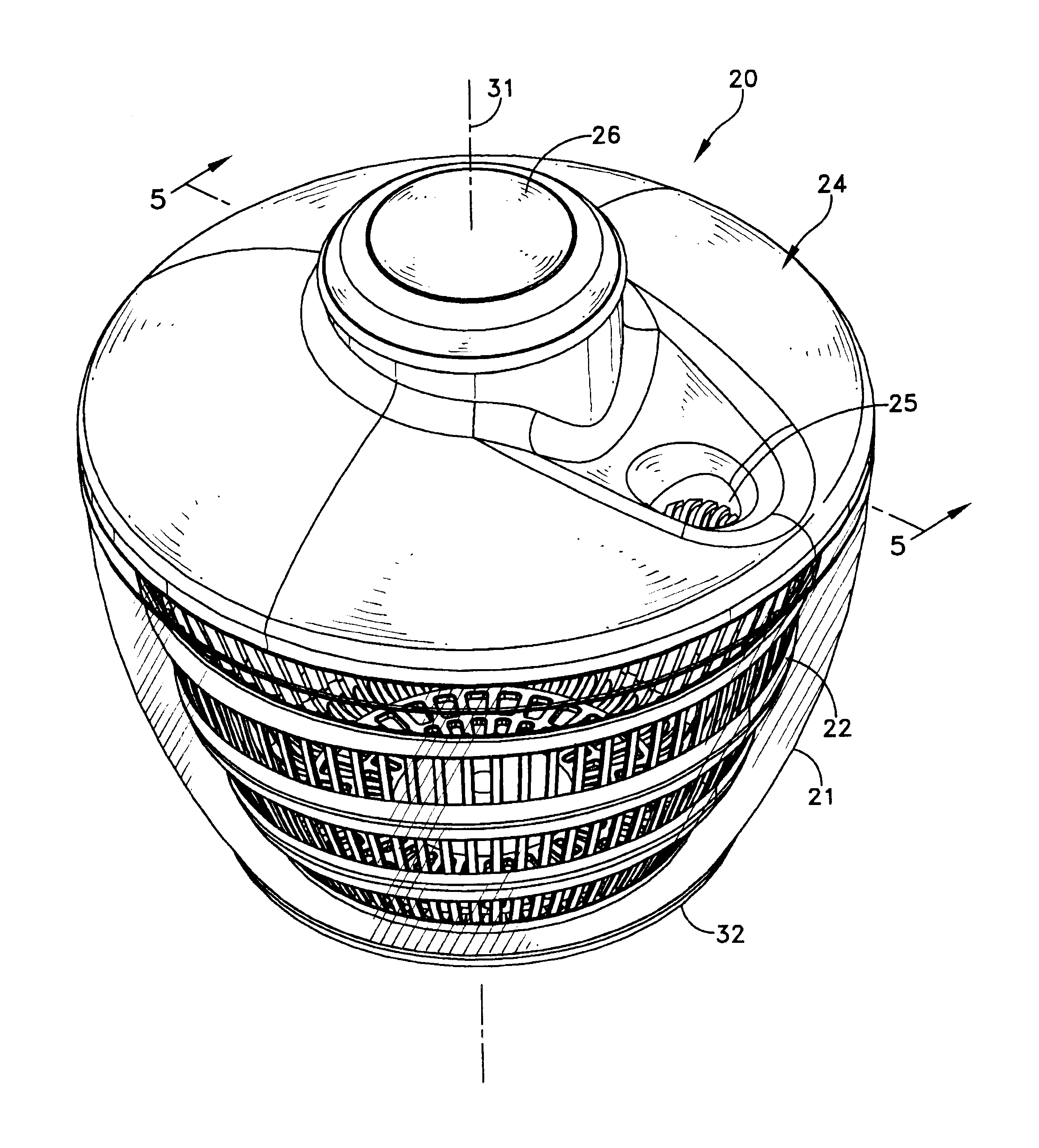

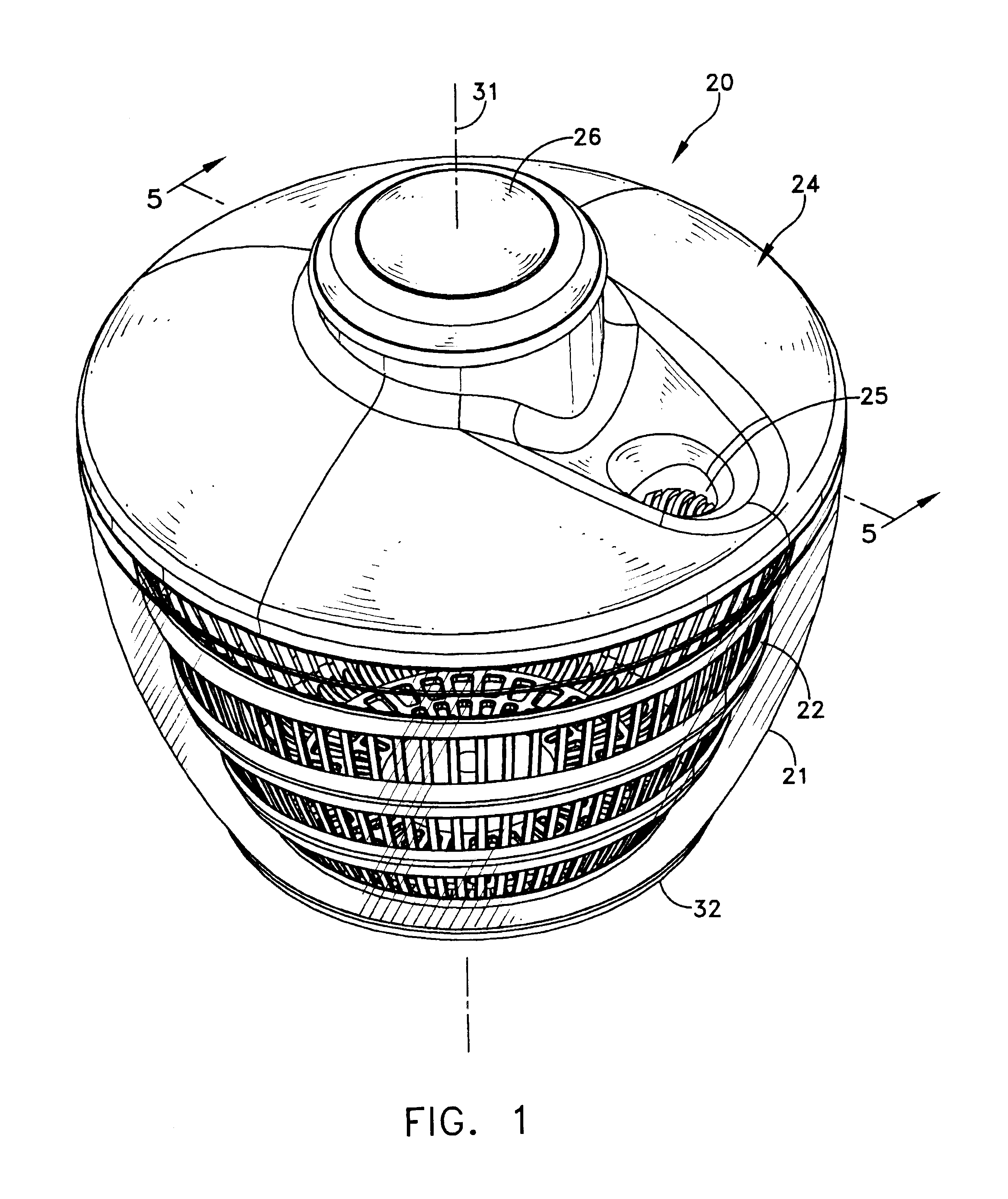

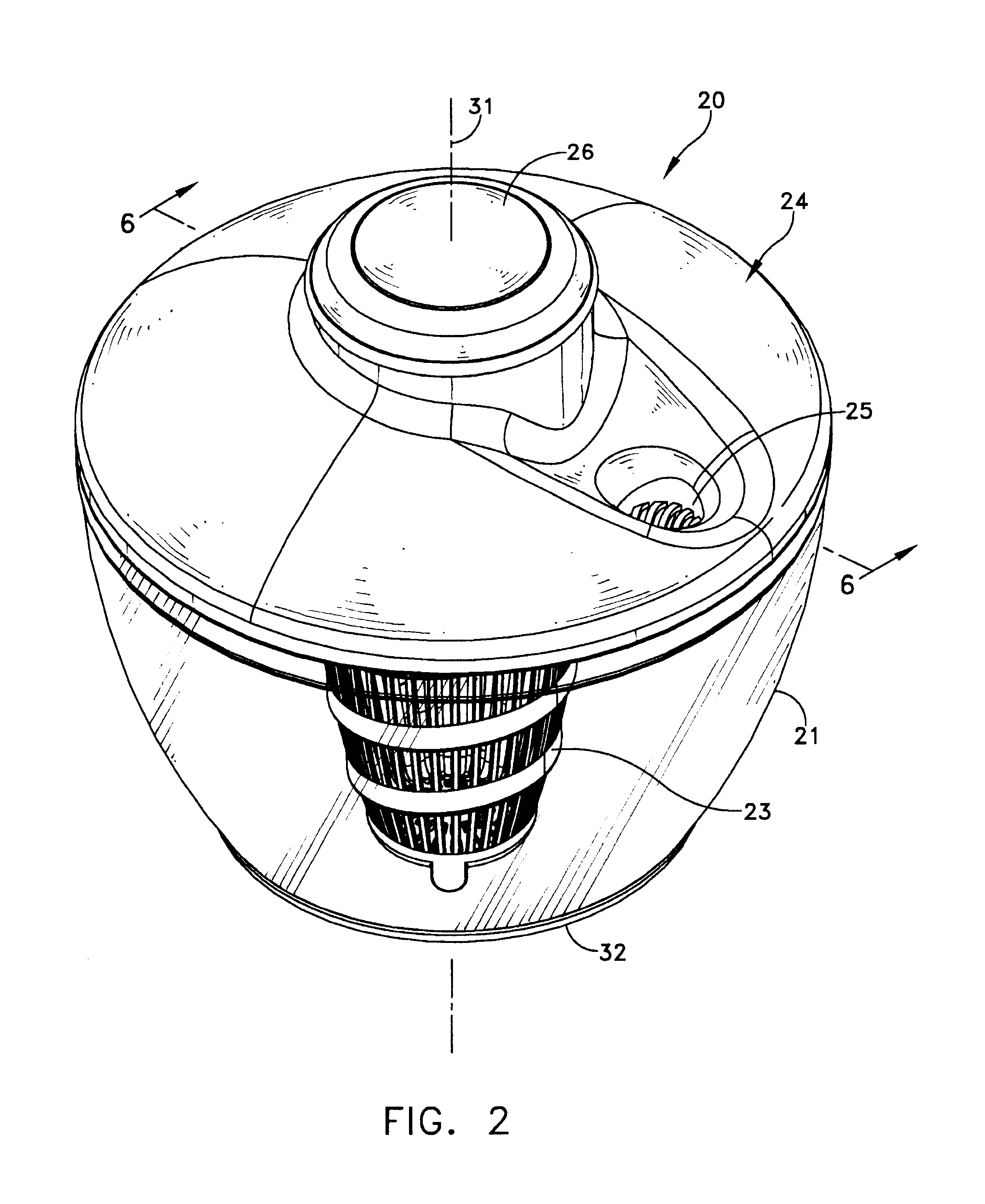

Salad spinner

InactiveUS6622618B1Easy to useConstant speedWater/sewage treatment by centrifugal separationJuice extractionDrive wheelEngineering

Owner:MEYER INTPROP

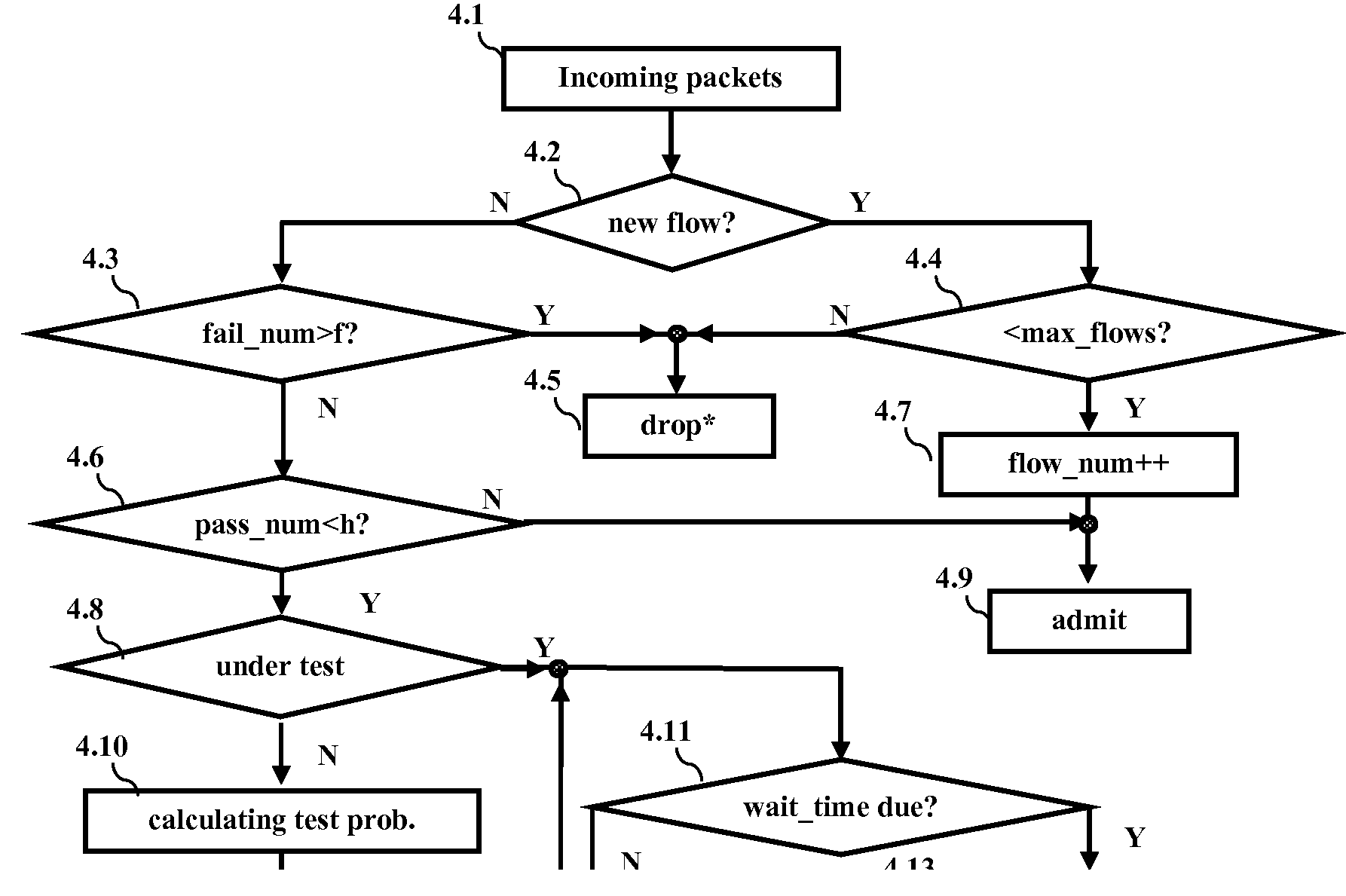

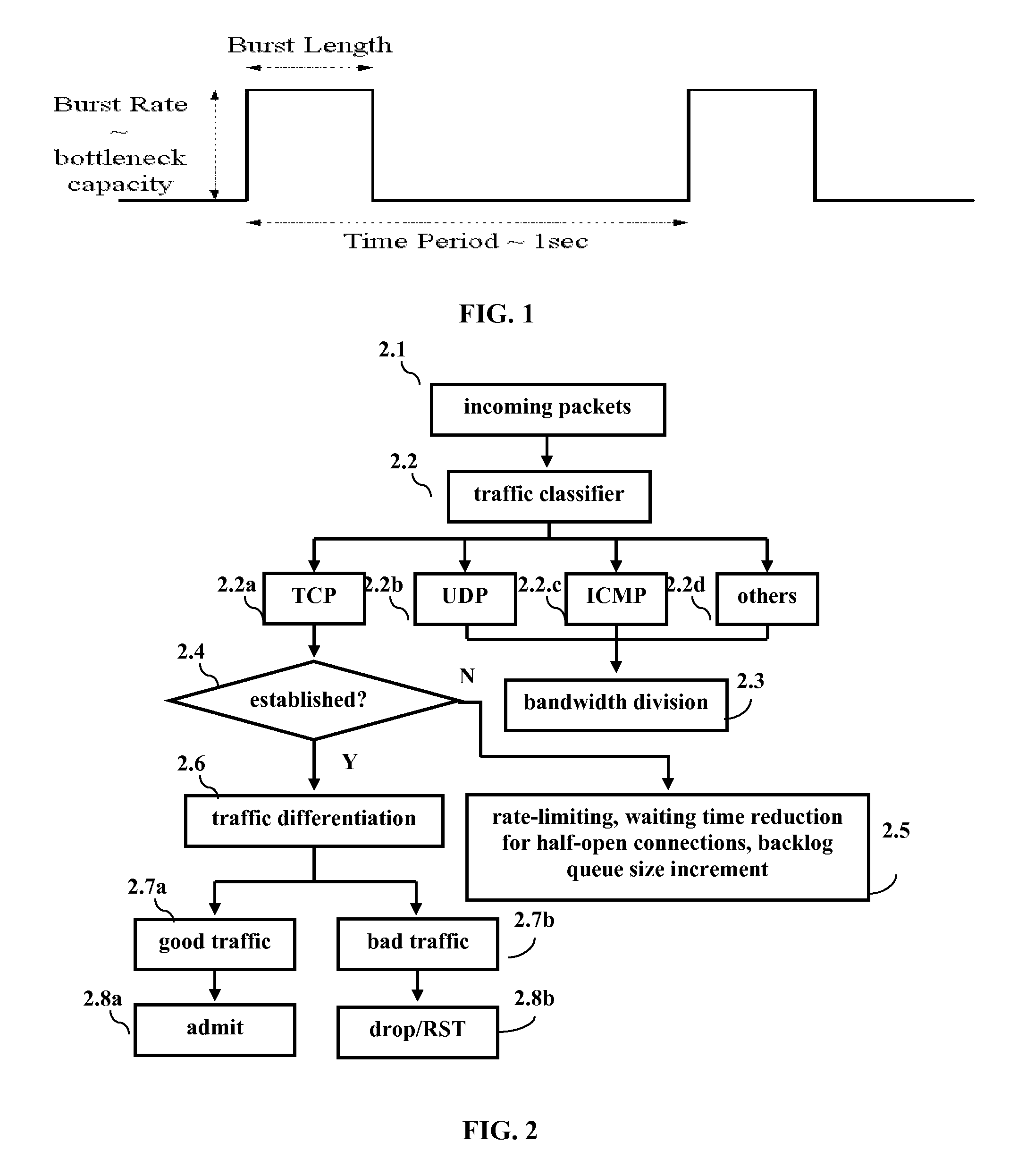

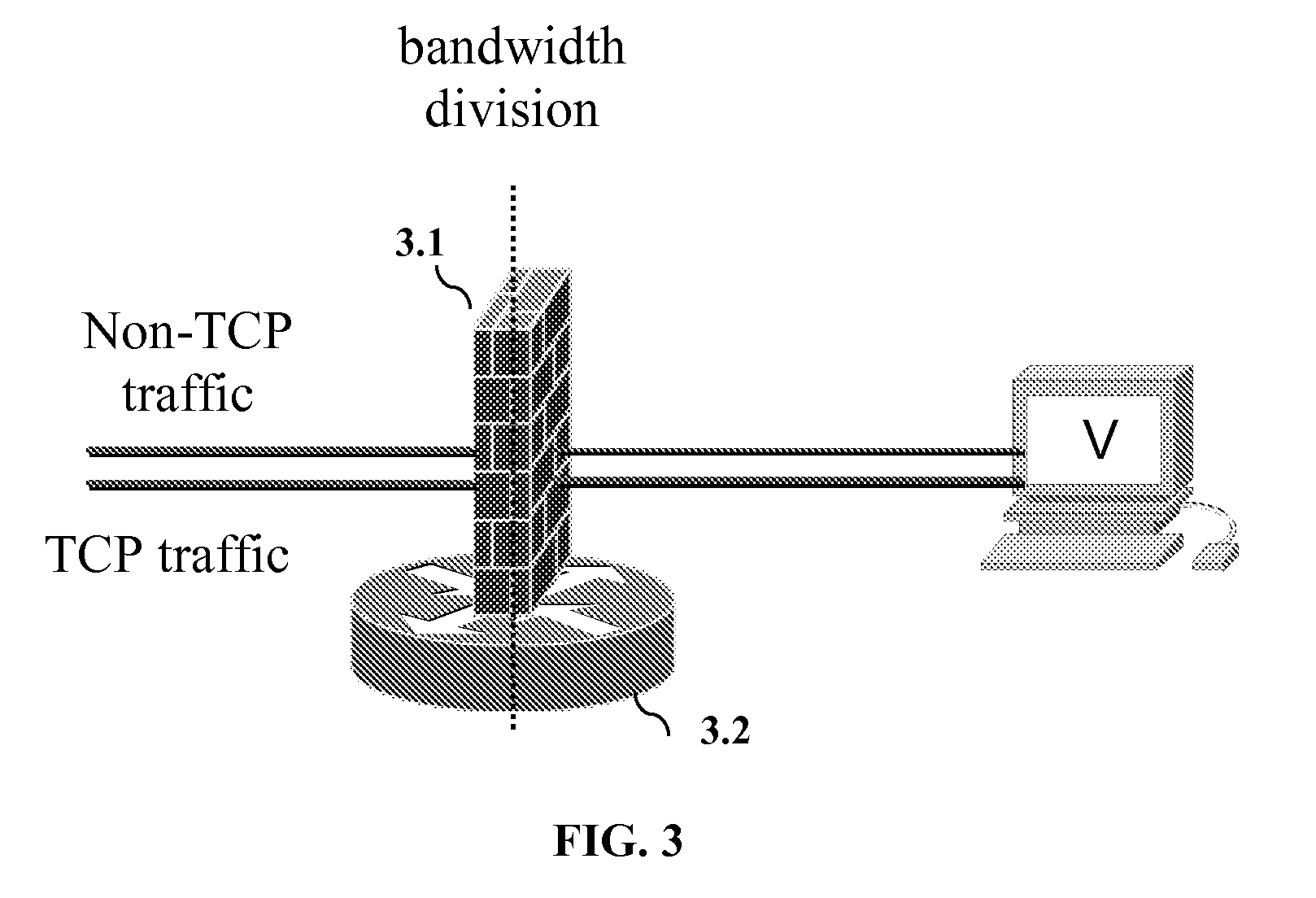

BEHAVIOR-BASED TRAFFIC DIFFERENTIATION (BTD) FOR DEFENDING AGAINST DISTRIBUTED DENIAL OF SERVICE (DDoS) ATTACKS

ActiveUS20070209068A1Improve throughputMinimal requirementMultiple digital computer combinationsTransmissionTraffic differentiationEngineering

Embodiments are directed toward a method for Behavior-based Traffic Differentiation (BTD) that initially receives incoming packets and performs traffic classification to determine the protocol of the incoming packets. In addition, BTD performs bandwidth division / allocation to further support traffic classification amongst non-TCP traffic such as UDP and ICMP. For TCP traffic, the method for BTD determines whether a TCP connection has been established and performs at least one of rate limiting, waiting time reduction for half-open connections, and incrementing backlog queue size when the TCP connection has not been established. If the TCP connection has been established successfully, the method for BTD further includes proactive tests for traffic differentiation which identify normal traffic, which is admitted, and attack traffic, which is dropped.

Owner:NEW JERSEY INSTITUTE OF TECHNOLOGY

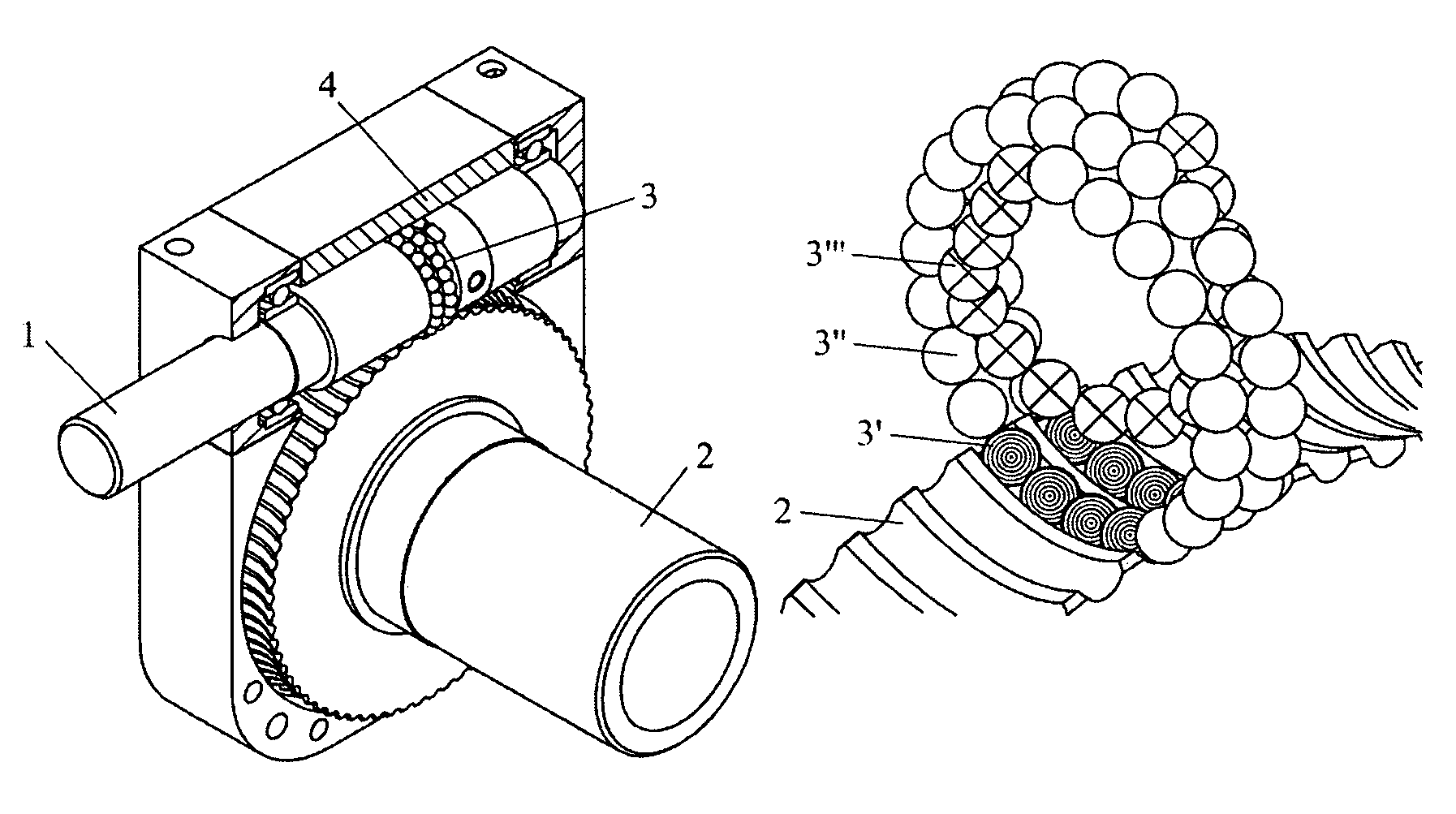

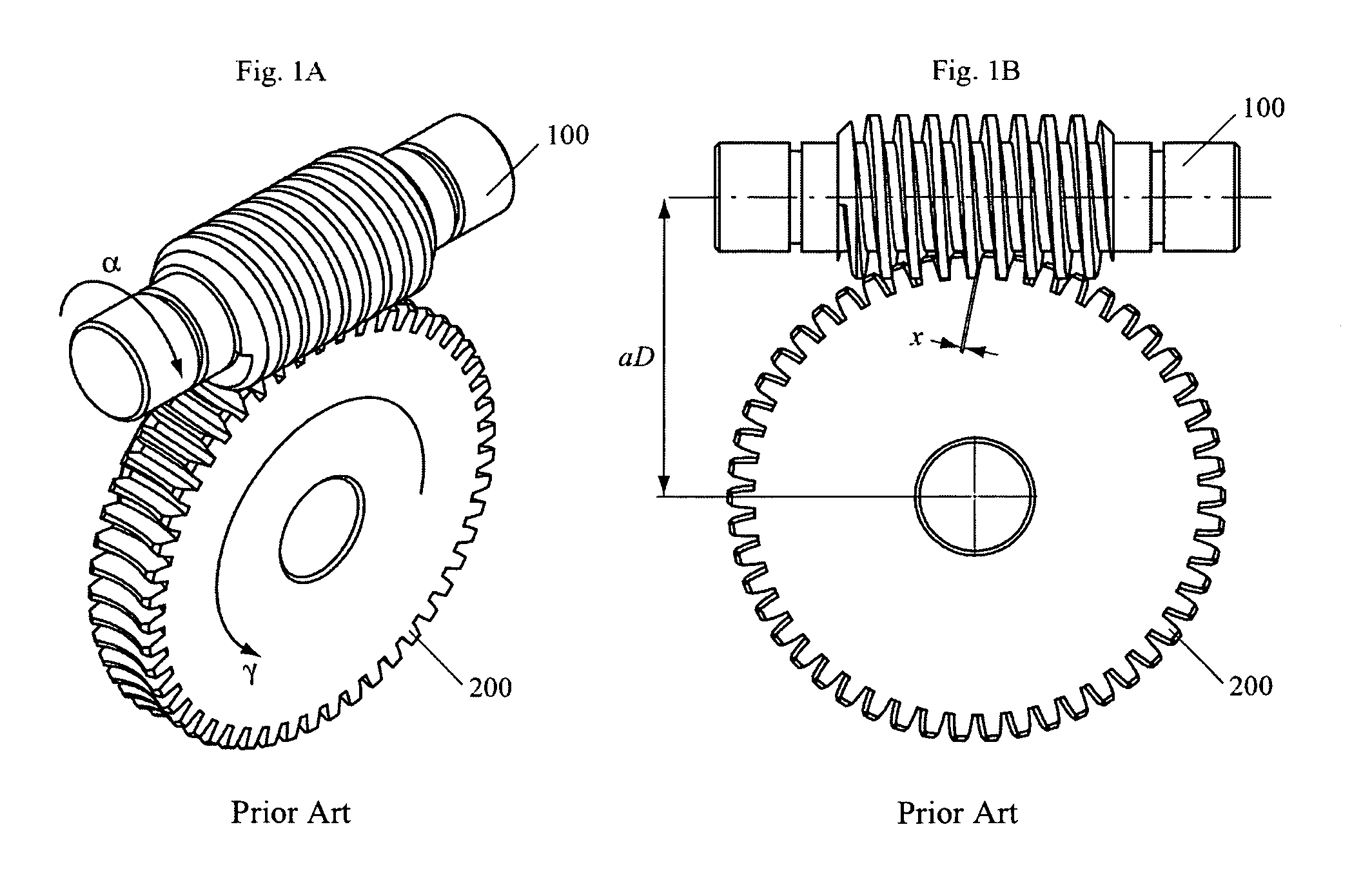

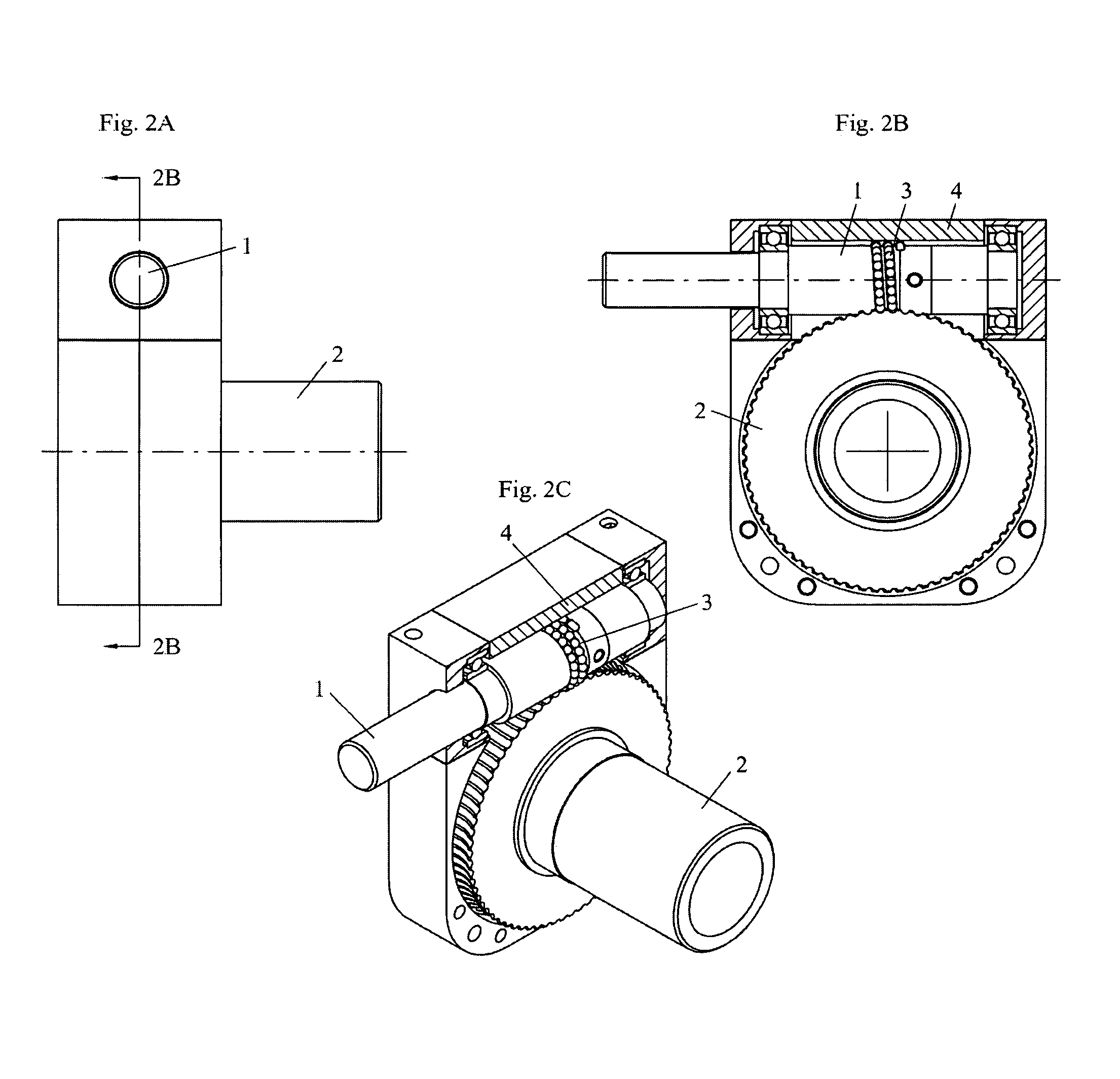

Ball-worm transmission

InactiveUS7051610B2Improve performanceAugments a number of ballsLinear bearingsToothed gearingsGear wheelEngineering

A ball-worm transmission is provided which replaces the sliding friction of the classic worm mechanism with the rolling friction of spherical balls. The ball-worm transmission assembly includes a worm which defines a recirculation path, and a gear coupled to the worm via a plurality of spherical balls. The gear includes a plurality of teeth each having a thickness in a central plane of the gear and a lesser thickness towards both sides of the gear, so that a gap is defined between the teeth is larger towards both sides of the gear than in the central plane of the gear.

Owner:HOLTZ DOUGLAS

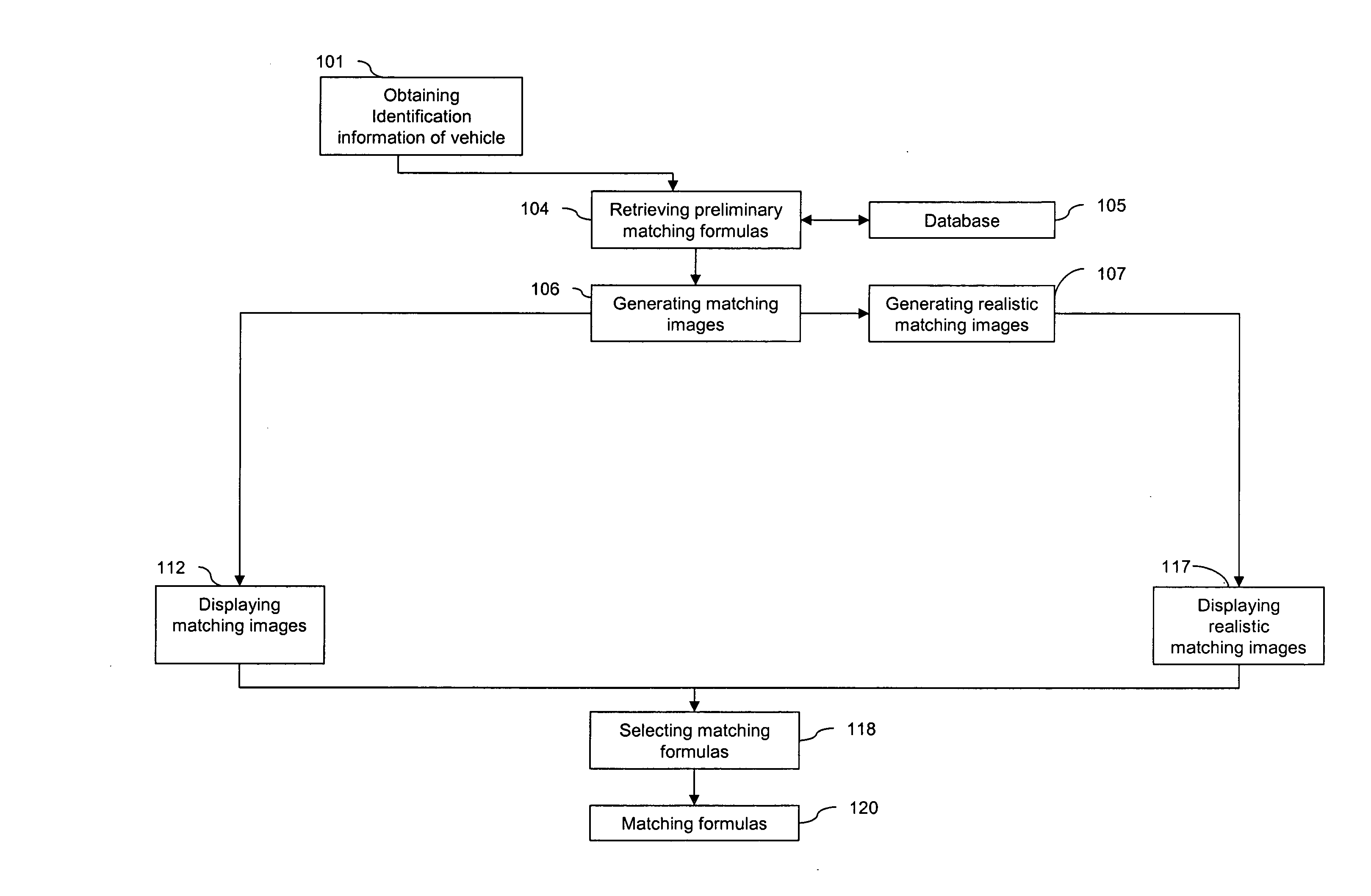

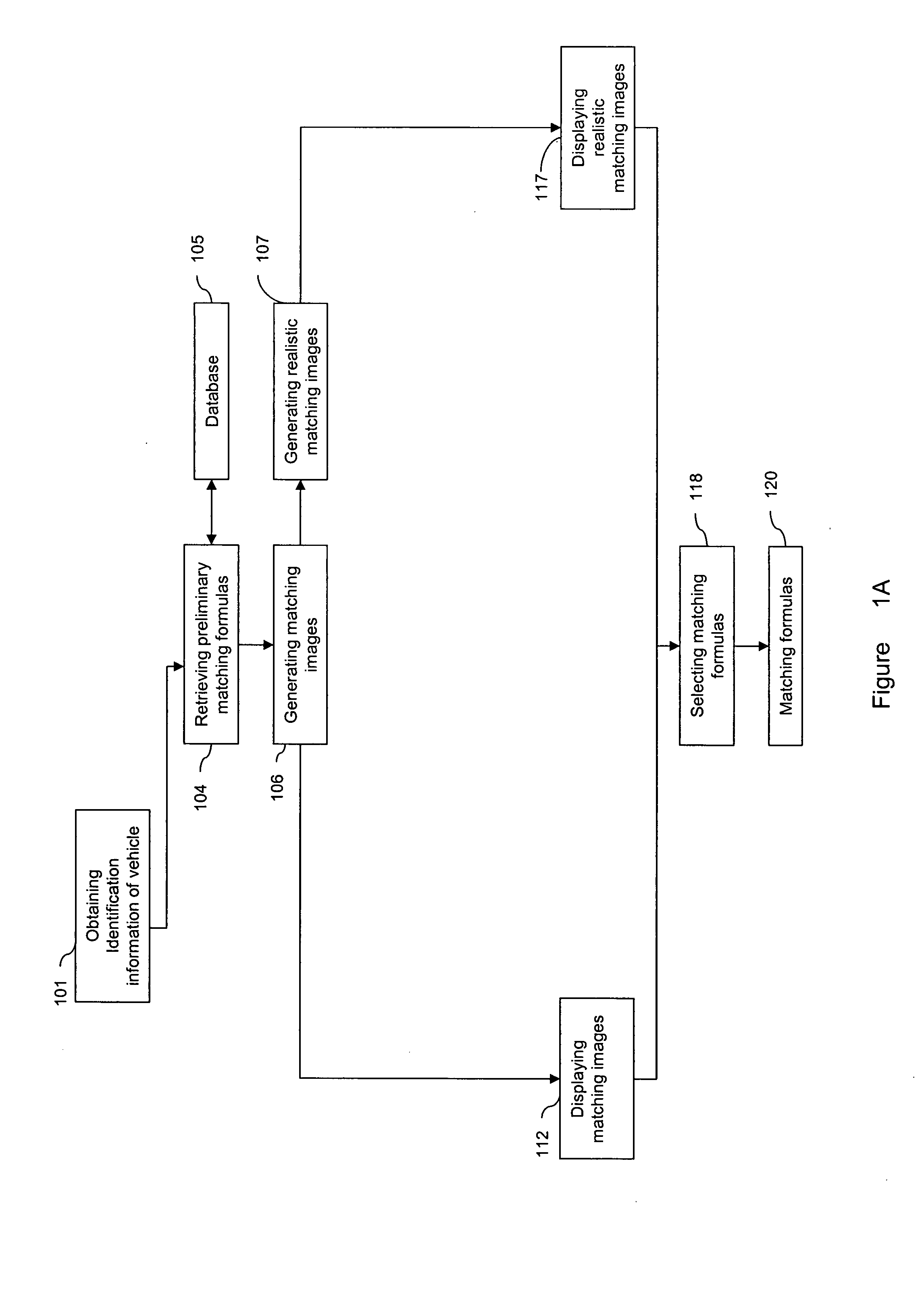

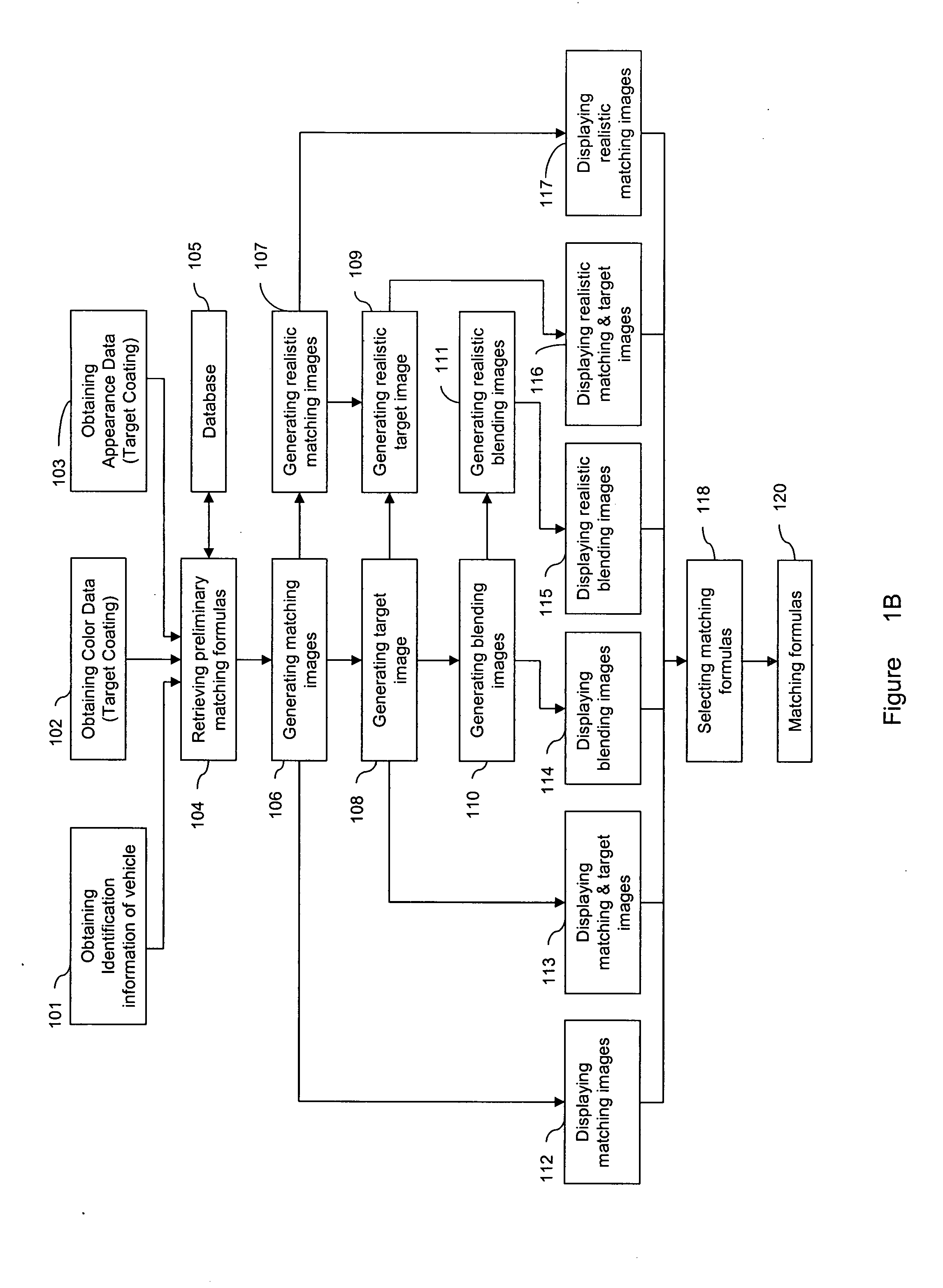

Digital display of color and appearance and the use thereof

InactiveUS20080235224A1Minimal requirementDigital data processing detailsStill image data browsing/visualisationComputer visionCoating

The present invention is directed to a method for digital displaying images of various colors and appearances of an article and the use thereof. The invention is particularly directed to a method for displaying one or more images to select one or more matching formulas to match color and appearance of an article. The invention is even further directed to a method for displaying one or more images to select one or more matching formulas to match color and appearance of a target coating of a vehicle.

Owner:AXALTA COATING SYST IP CO LLC

Materials for selective deposition modeling

InactiveUS6133355AHandling dimensionalToughness handlingAdditive manufacturing apparatusPaper coatingParaffin waxMicrocrystalline wax

A novel thermopolymer material adapted for use in thermal stereolithography. More particularly, a thermopolymer material comprising a mixture of: a low shrinkage polymer resin; a low viscosity material such as paraffin wax; at least one microcrystalline wax; a toughening polymer; a plasticizer. Alternative embodiments further include components to improve the materials ability to transfer heat and to improve strength. The subject material, together with the described process greatly reduce part building distortions while retaining desirable toughness, strength and jetting properties.

Owner:3D SYST INC

Fetching application and driver for extension device from network

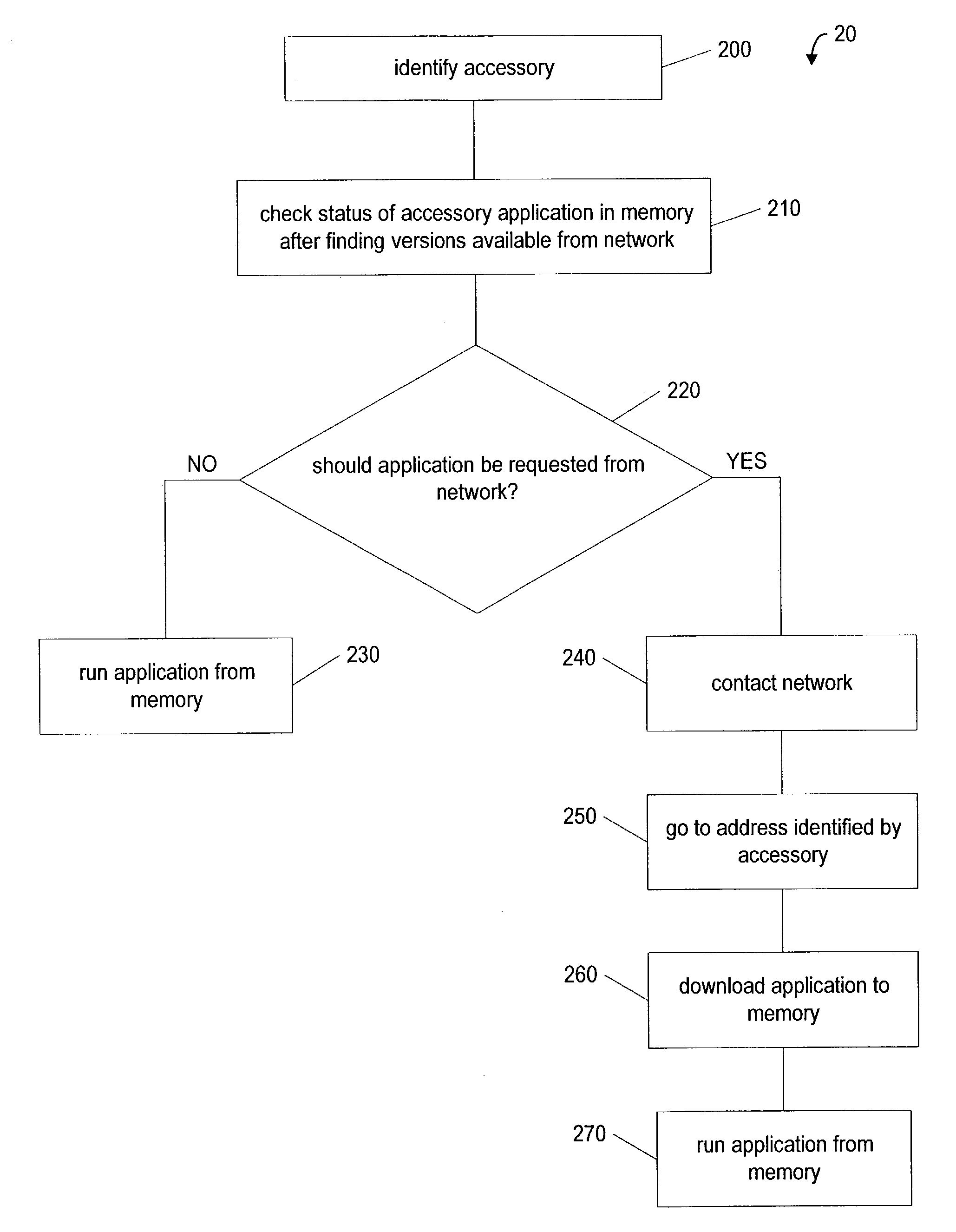

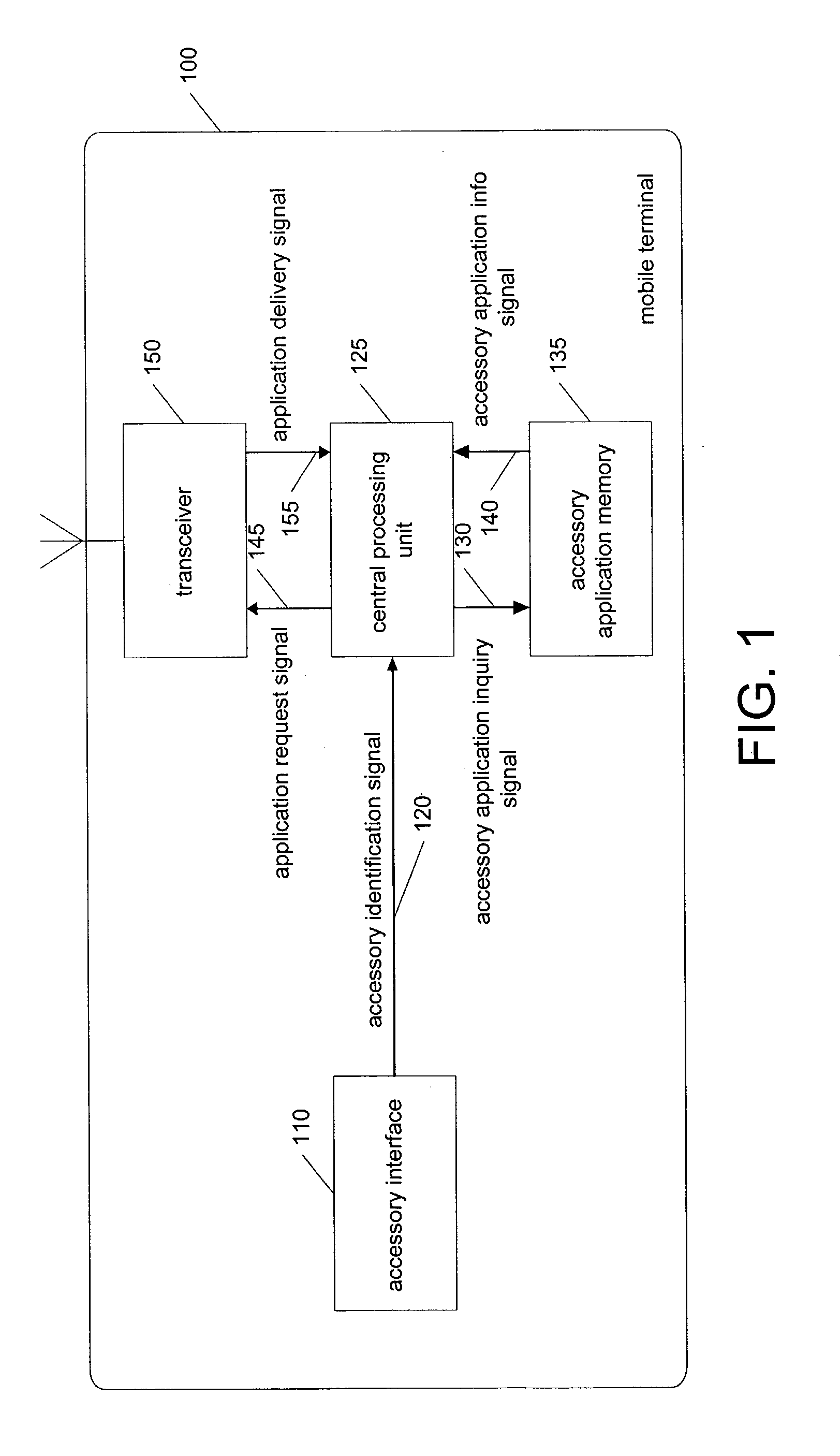

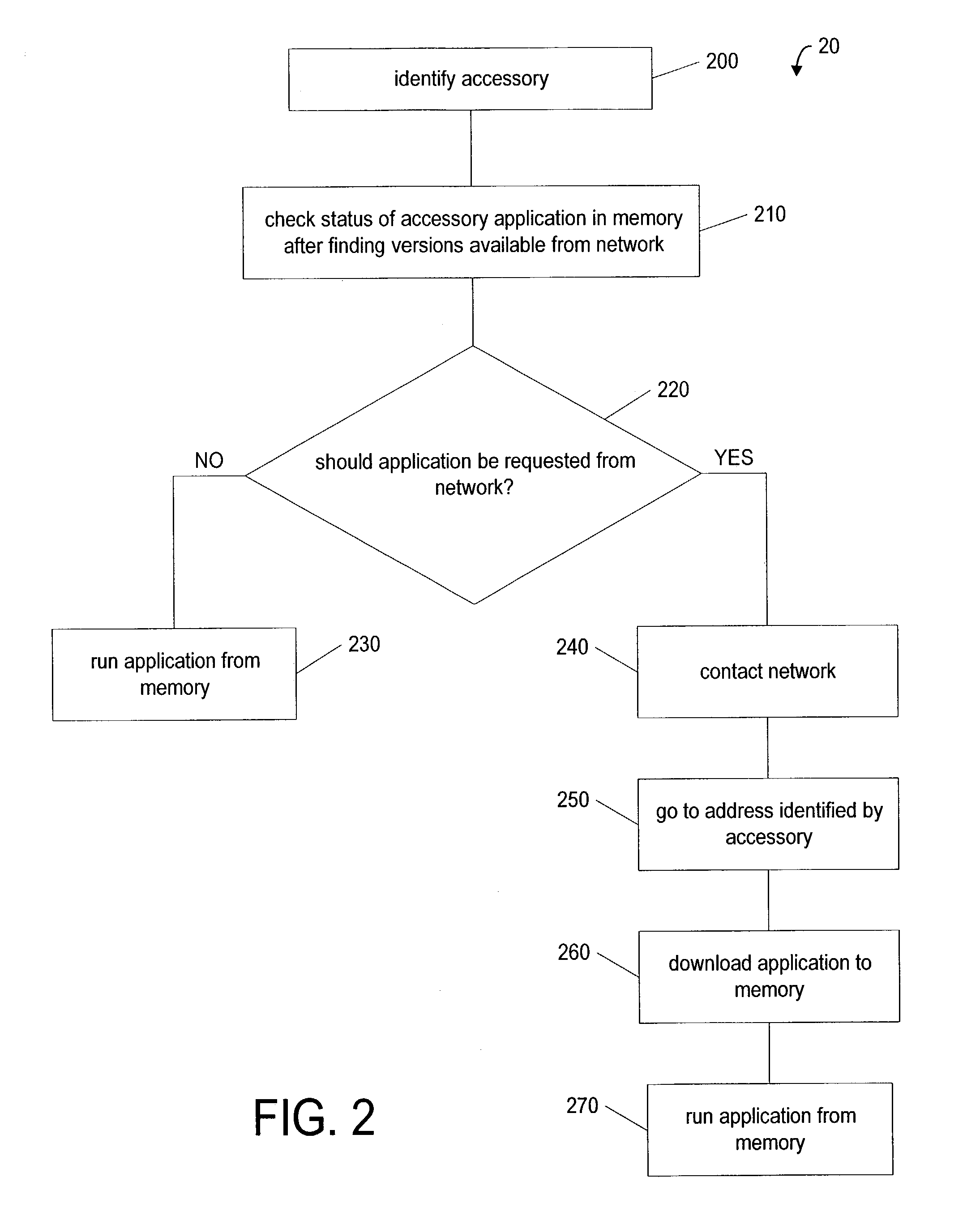

ActiveUS7062260B2Reduce memory requirementCost reductionSubstation equipmentAutomatic exchangesApplication softwareTelecommunications network

A method and apparatus are provided so that a mobile terminal will obtain an application for an accessory of the mobile terminal from a telecommunications network. The mobile terminal includes an accessory interface, responsive to connection with the accessory, for providing an accessory identification to a processing unit within the mobile terminal. The processing unit makes an accessory application inquiry to an accessory application memory within the mobile terminal. The memory provide information regarding a stored application, and then the processing unit makes an application request to a network, if the information indicates status of the stored application is inadequate.

Owner:IRONWORKS PATENTS LLC

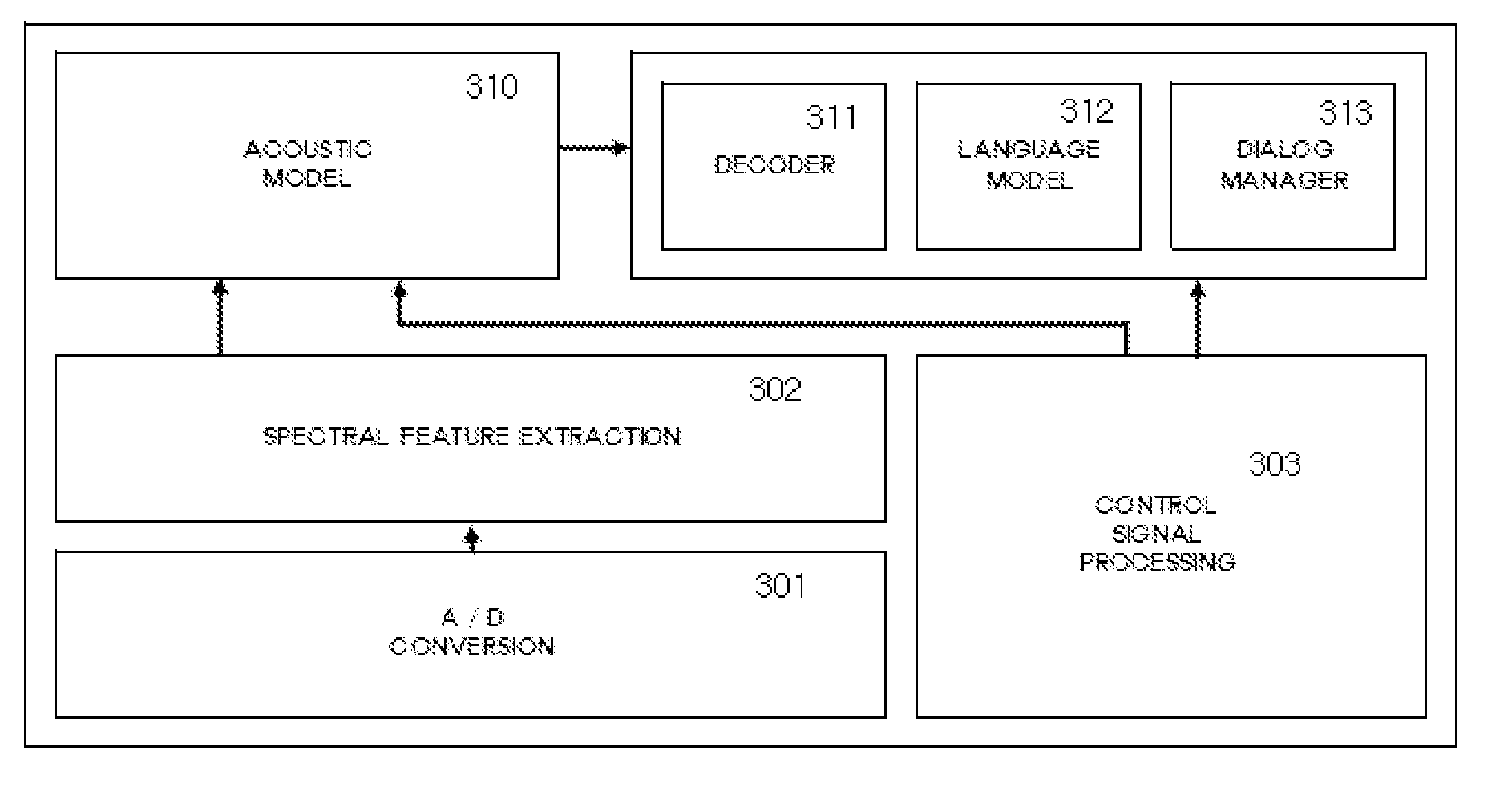

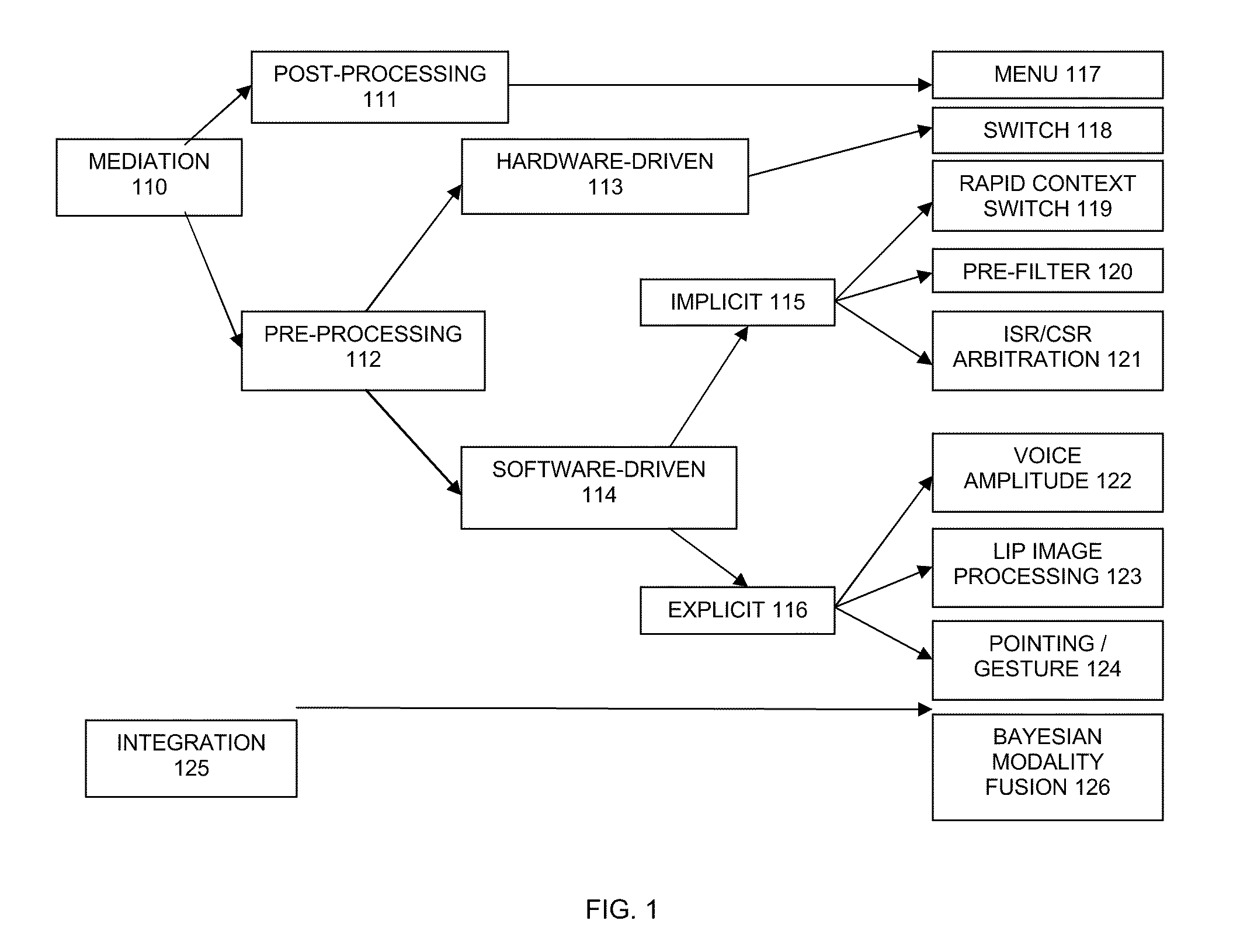

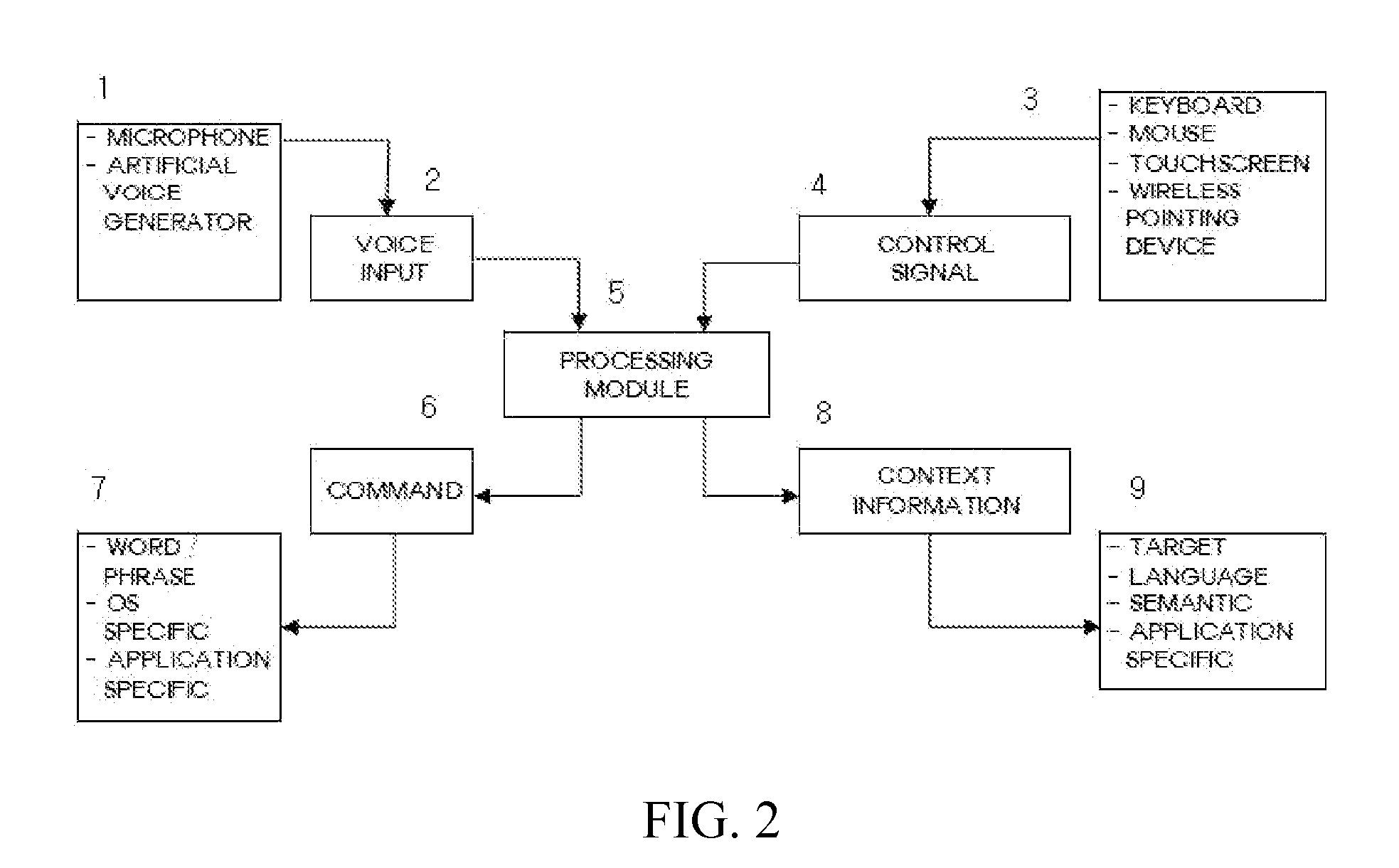

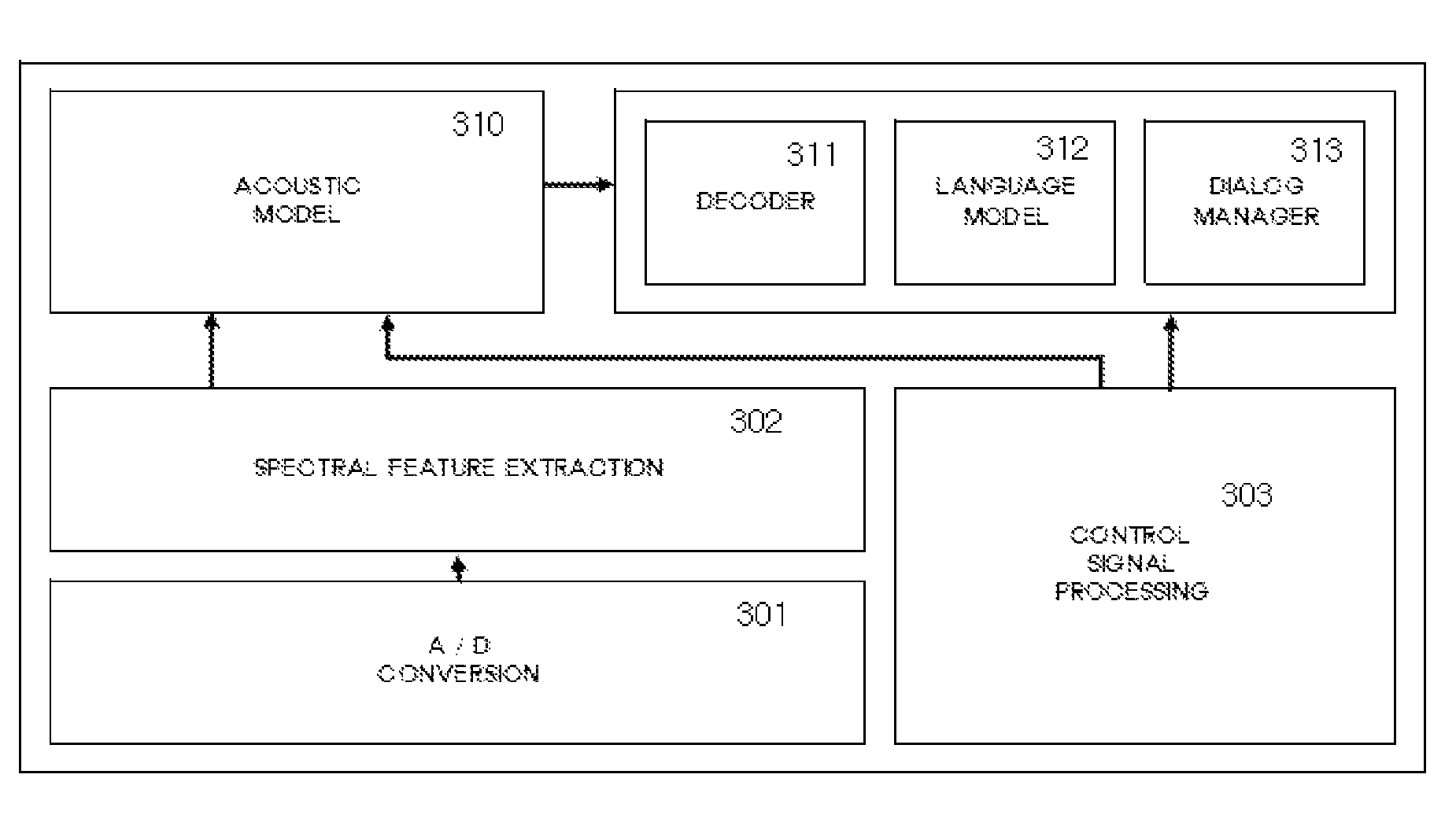

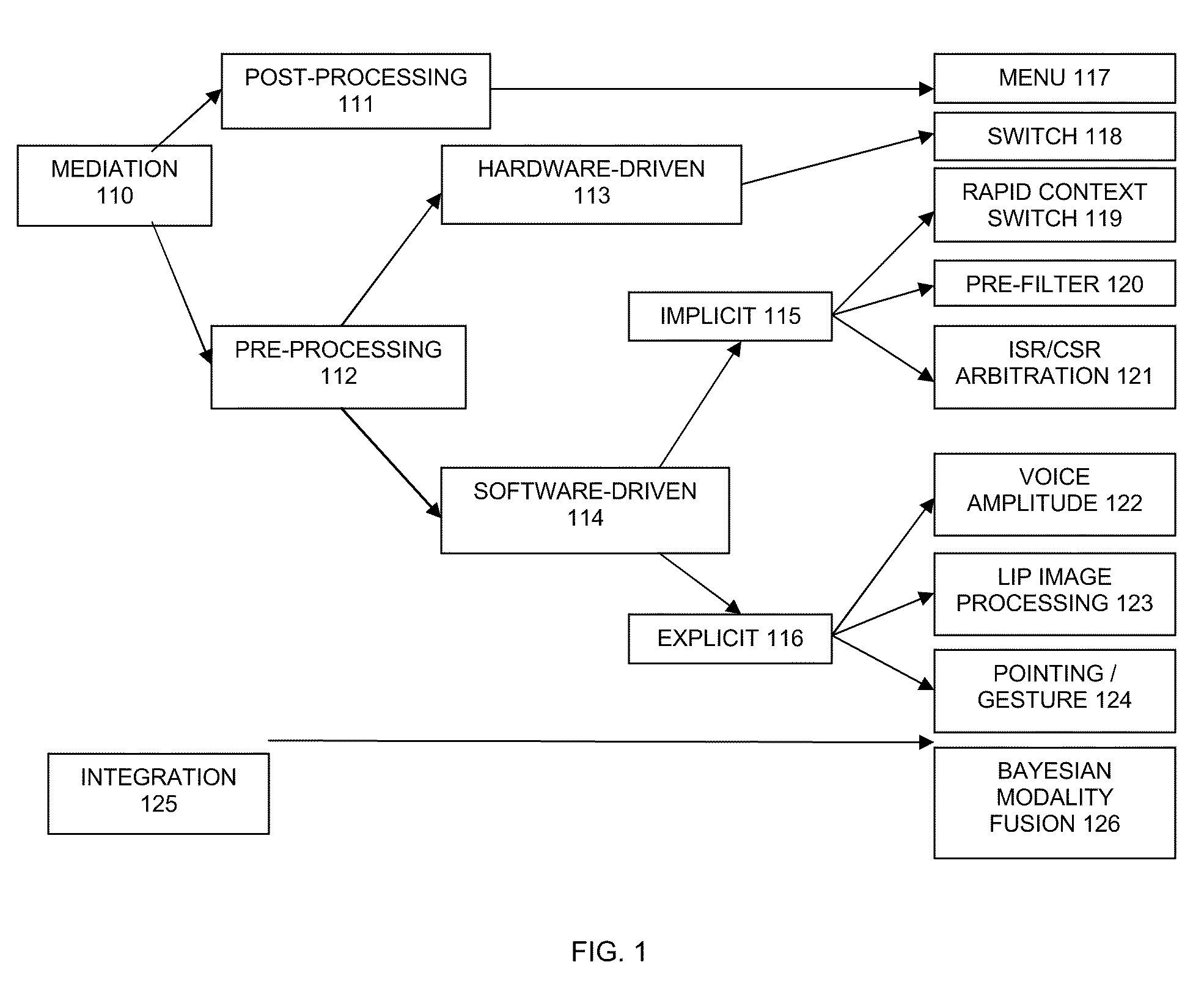

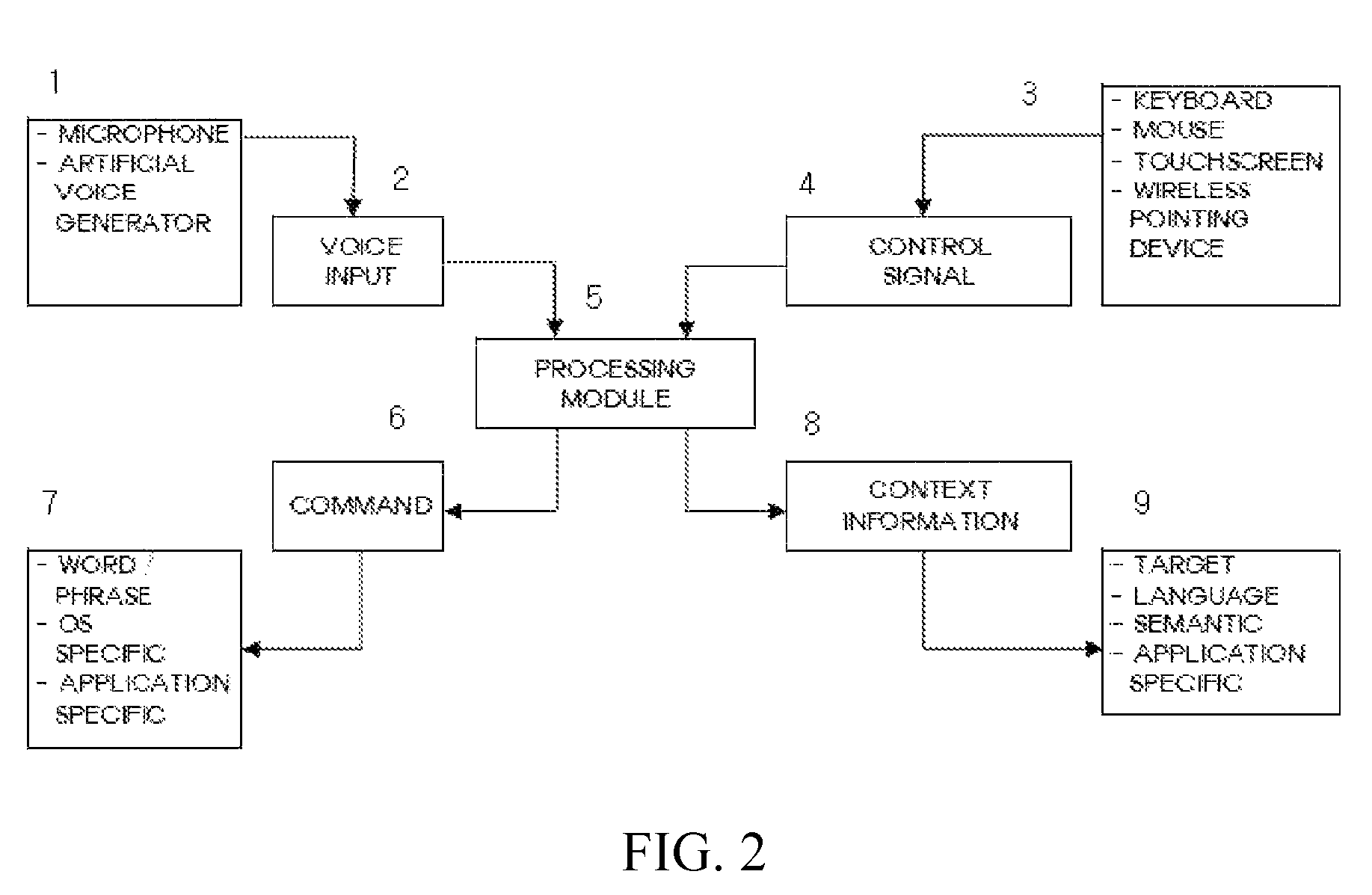

Multimodal unification of articulation for device interfacing

InactiveUS20100070268A1Facilitates inferenceEasy to explainSpeech recognitionControl signalSpeech identification

A system for a multimodal unification of articulation includes a voice signal modality to receive a voice signal, and a control signal modality which receives an input from a user and generates a control signal from the input which is selected from predetermined inputs directly corresponding to the phonetic information. The interactive voice based phonetic input system also includes a multimodal integration system to receive and integrates the voice signal and the control signal. The multimodal integration system delimits a context of a spoken utterance of the voice signal by using the control signal to preprocess and discretize into phonetic frames. A voice recognizer analyzing the voice signal integrated with the control signal to output a voice recognition result. This new paradigm helps overcome constraints found in interfacing mobile devices. Context information facilitates the handling of the commands in the application environment.

Owner:SUNG JUN HYUNG

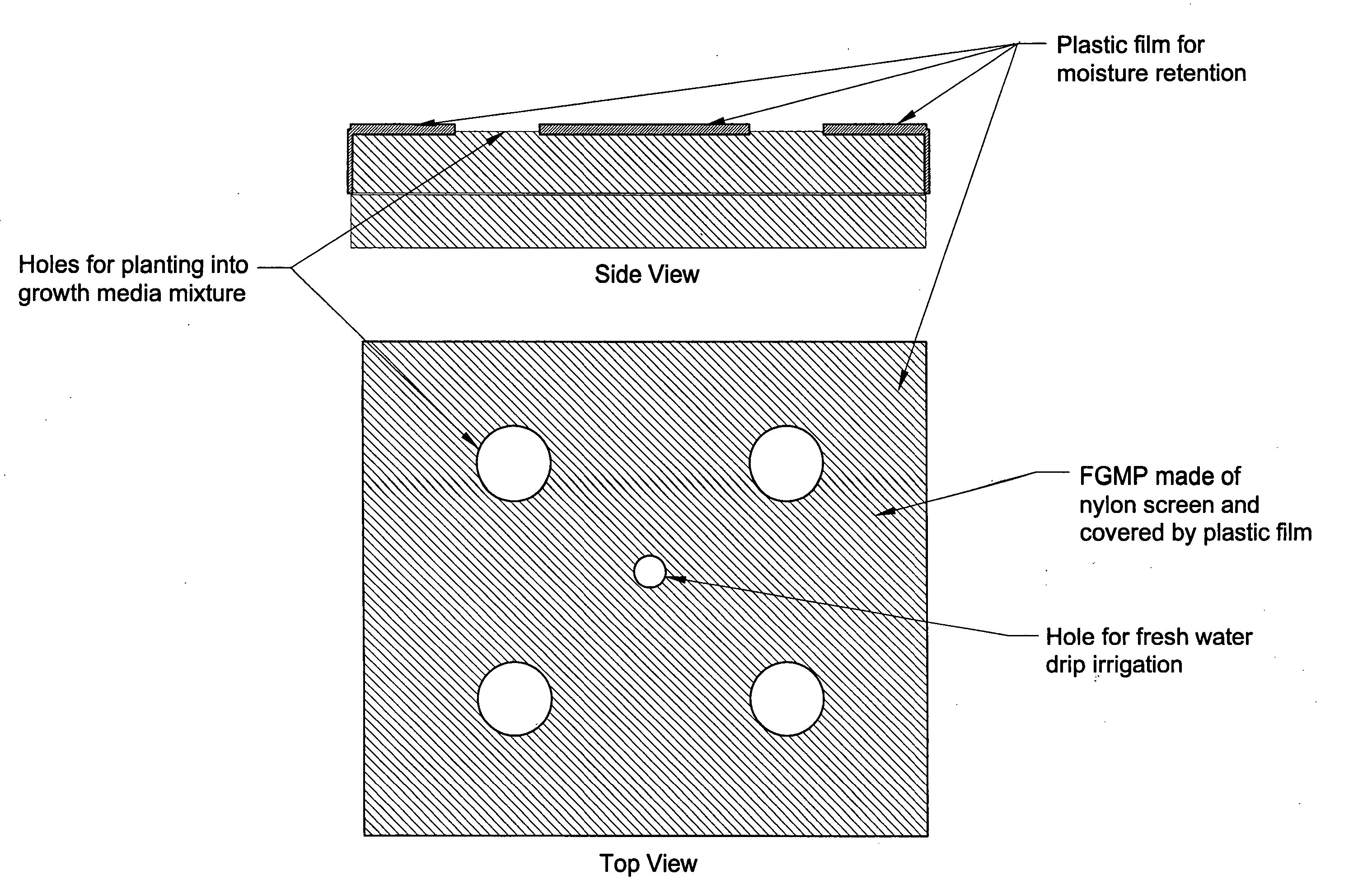

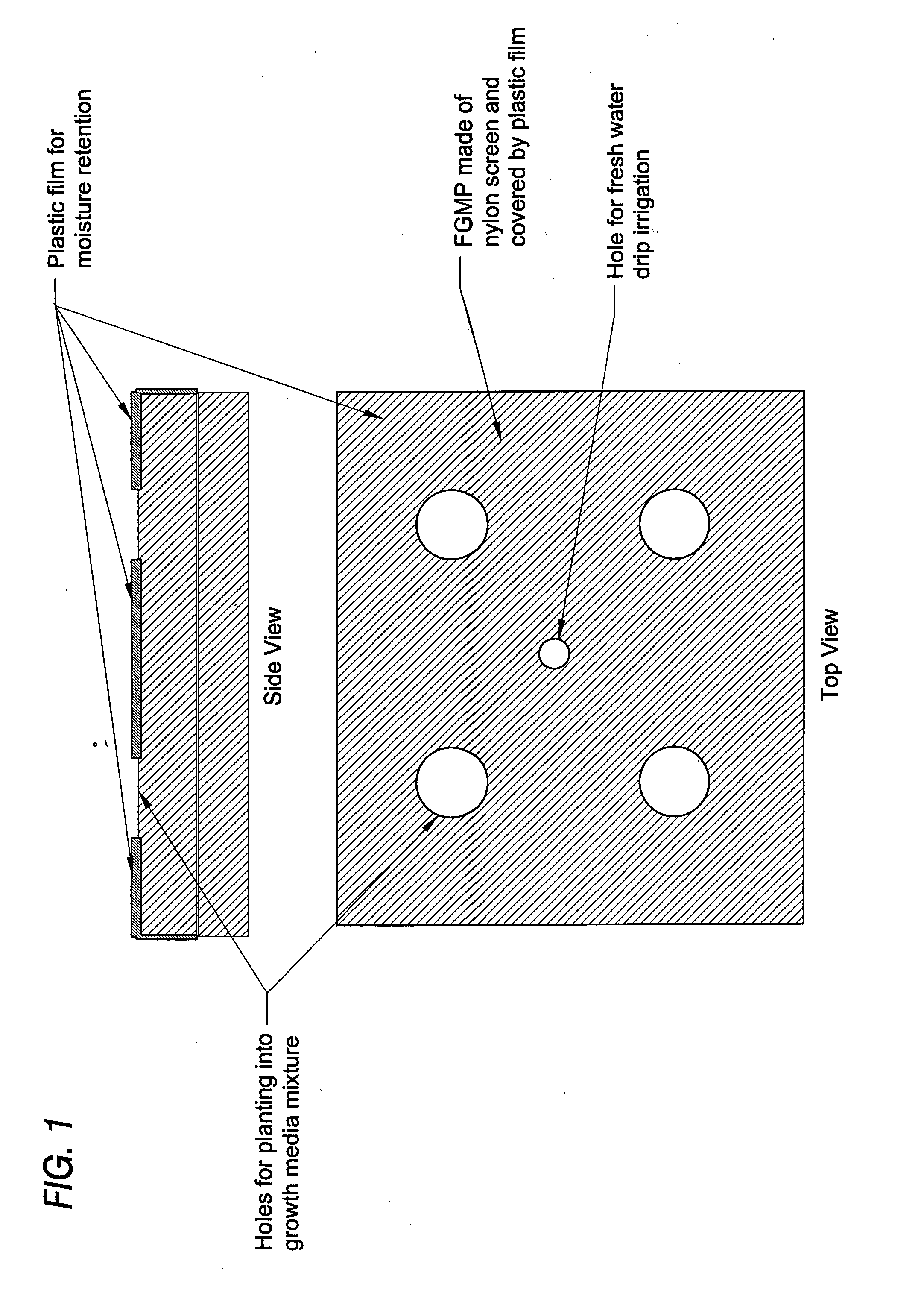

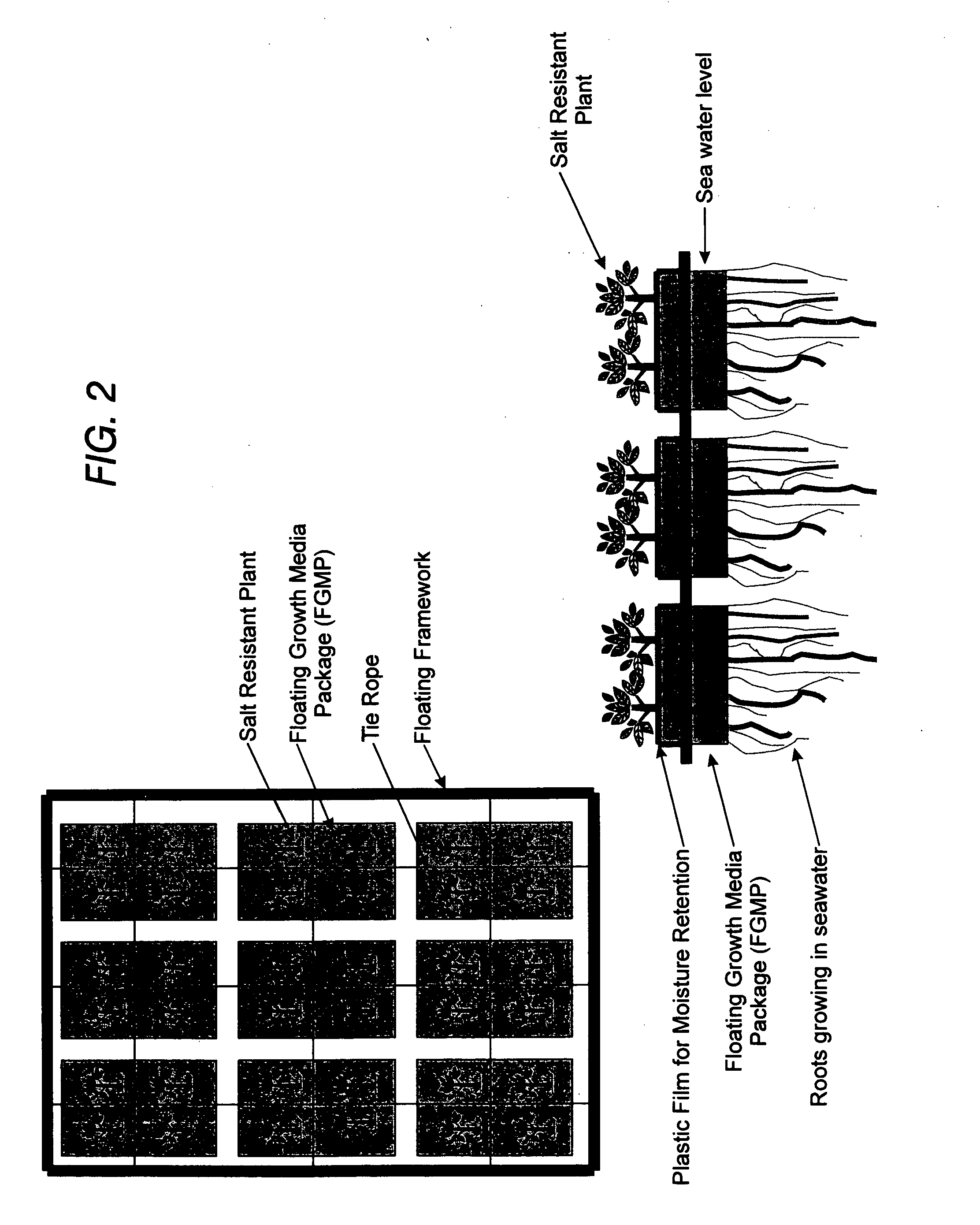

Floating plant cultivation platform and method for growing terrestrial plants in saline water of various salinities for multiple purposes

InactiveUS20050044788A1Efficient managementMinimal requirementSeed and root treatmentClimate change adaptationShootCell culture media

The cultivation of terrestrial plants in brackish water or seawater is carried out with this invention. A light-weight, floating growth medium package (FGMP) or, alternatively, a sheet of suitable material is used to support the growth of terrestrial plants floating on water bodies of various salinity, including 100% seawater in marine environments. The FGMP units can be linked together and confined in a floating, rigid or flexible framework to form a floating seawater cultivation platform (FSCP). Using the method, plants were able to grow and thrive on the FSCP floating on 100% seawater in a sustainable manner. Halophytic akulikuli (Sesuvium portulacastrum L.) can regenerate its shoot and root in seawater. Thus, the discovery will enable us to practice marine agriculture, or agriculture on the sea. The FSCP can be used for wide range of purposes, from environmental protection to landscaping to crop production.

Owner:UNIV OF HAWAII

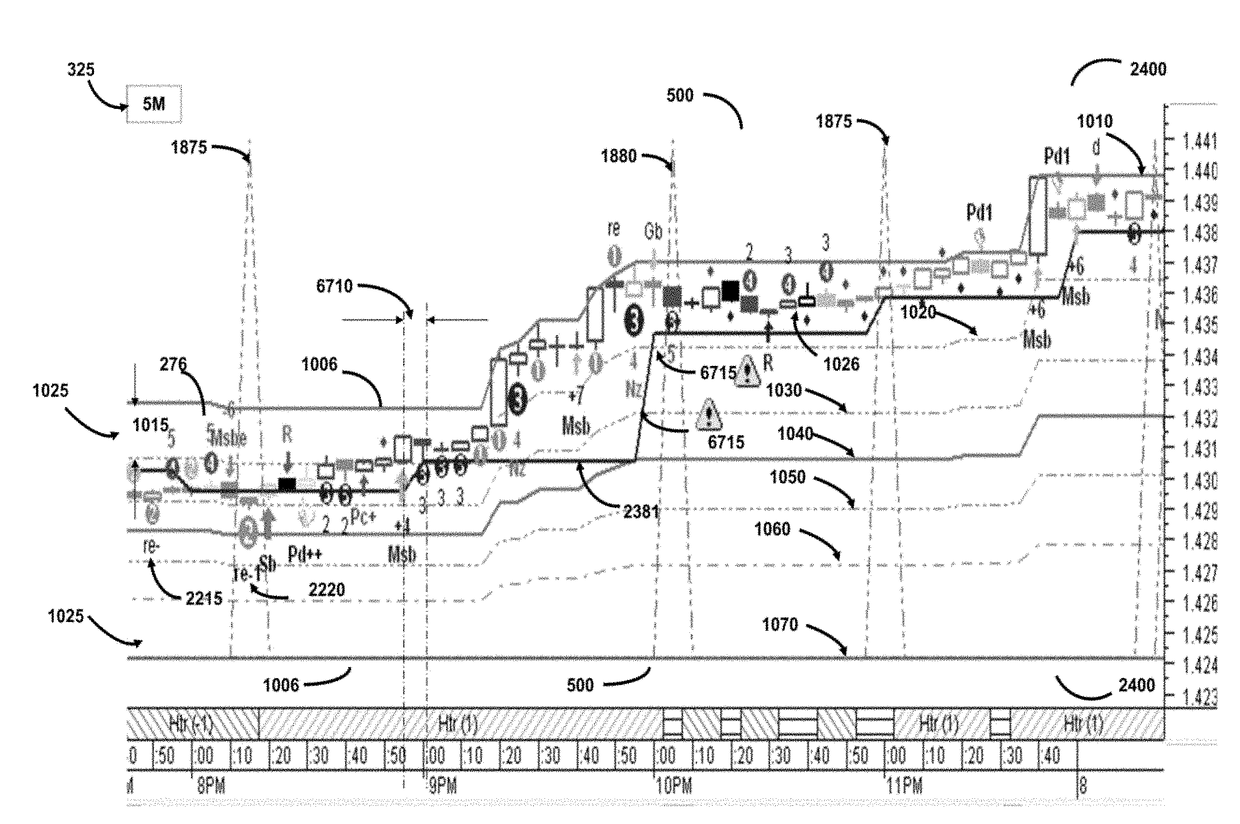

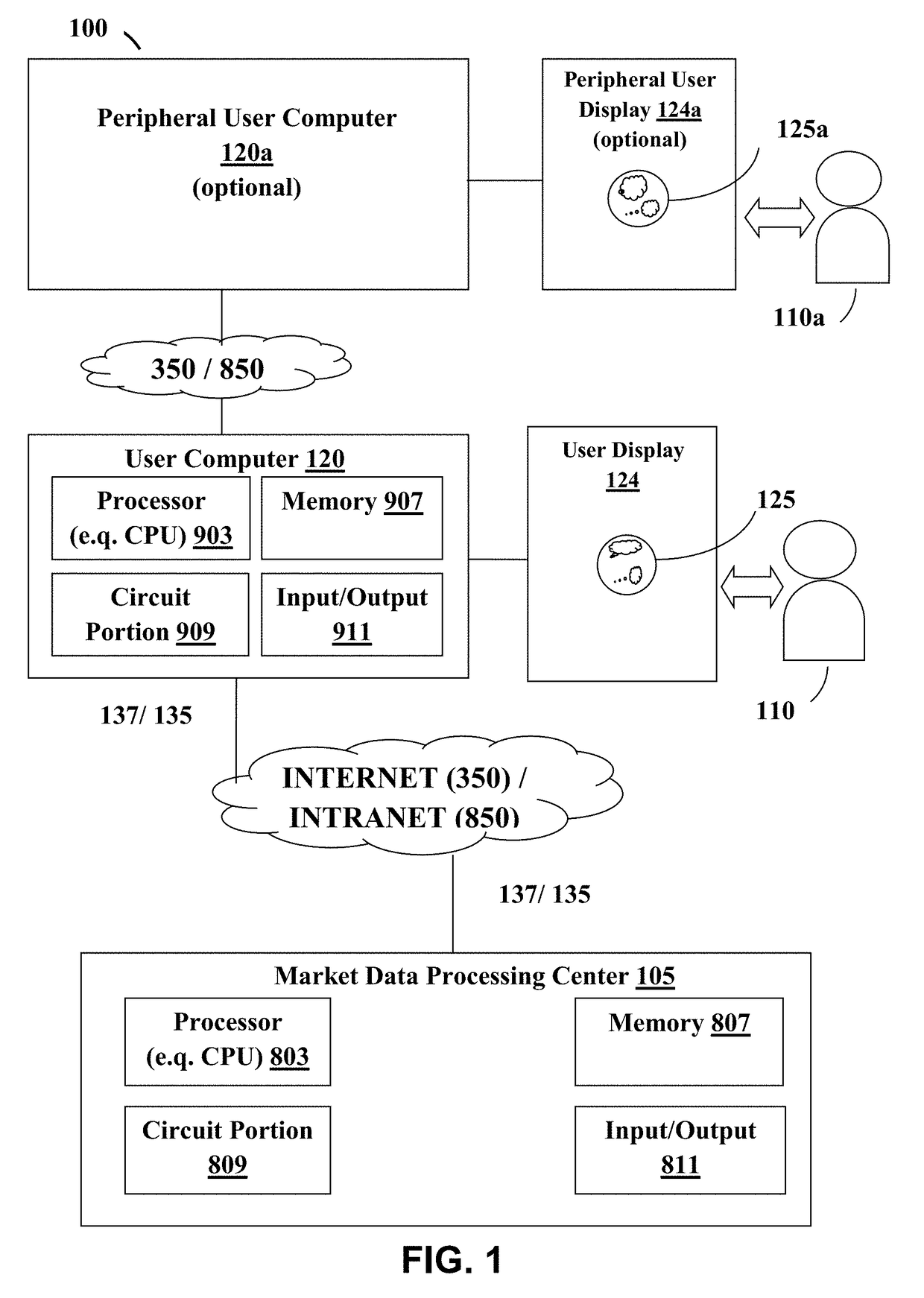

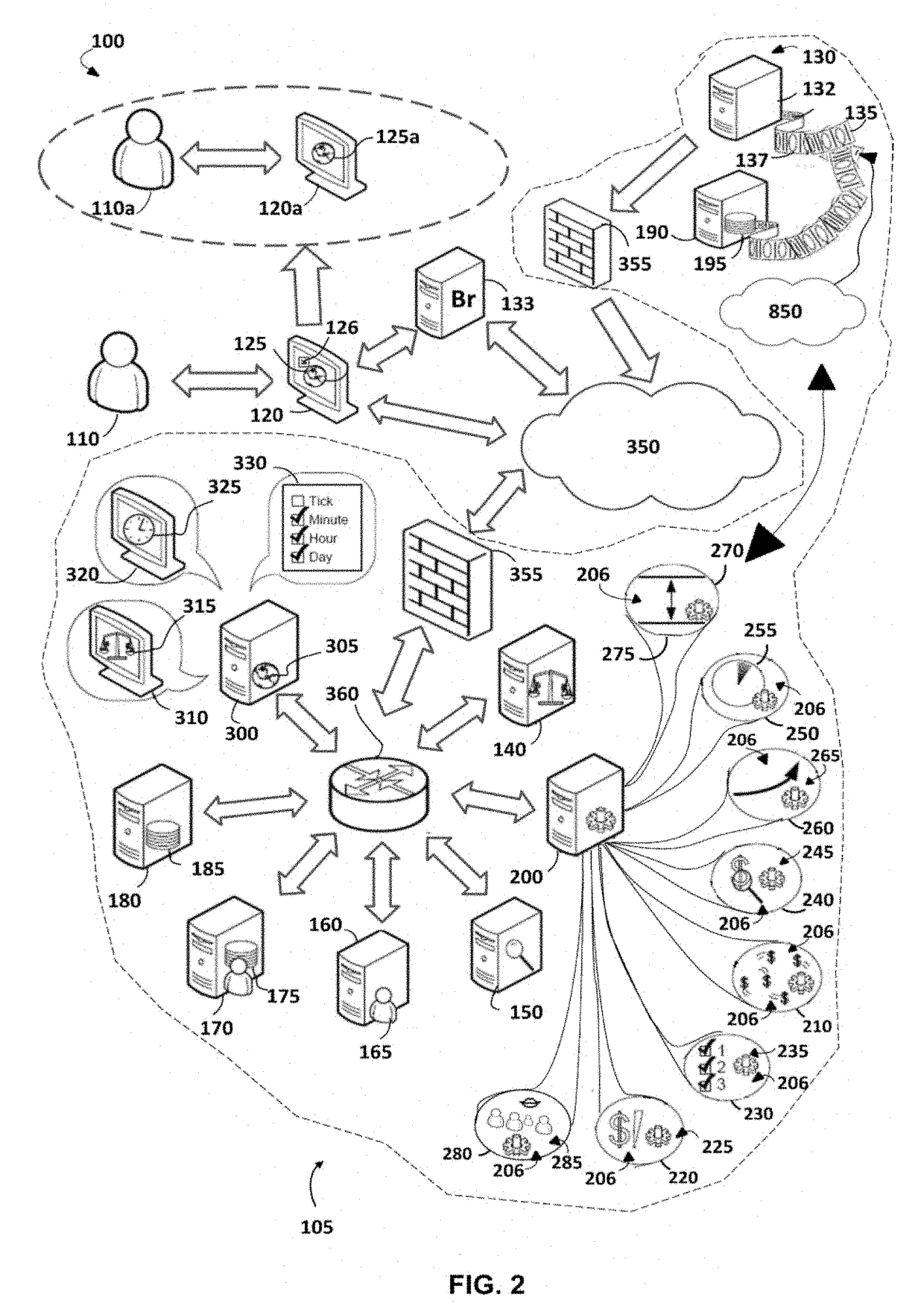

Multidimensional risk analysis

InactiveUS20170301024A1Limit number of unnecessaryEconomical environmentDrawing from basic elementsFinanceTime frameRisk category

Owner:DALAL PANKAJ B +1

Multidimensional risk analysis

InactiveUS20140297495A1Limit number of unnecessaryEconomical environmentFinanceTime frameMotion estimation

Owner:DALAL PANKAJ B

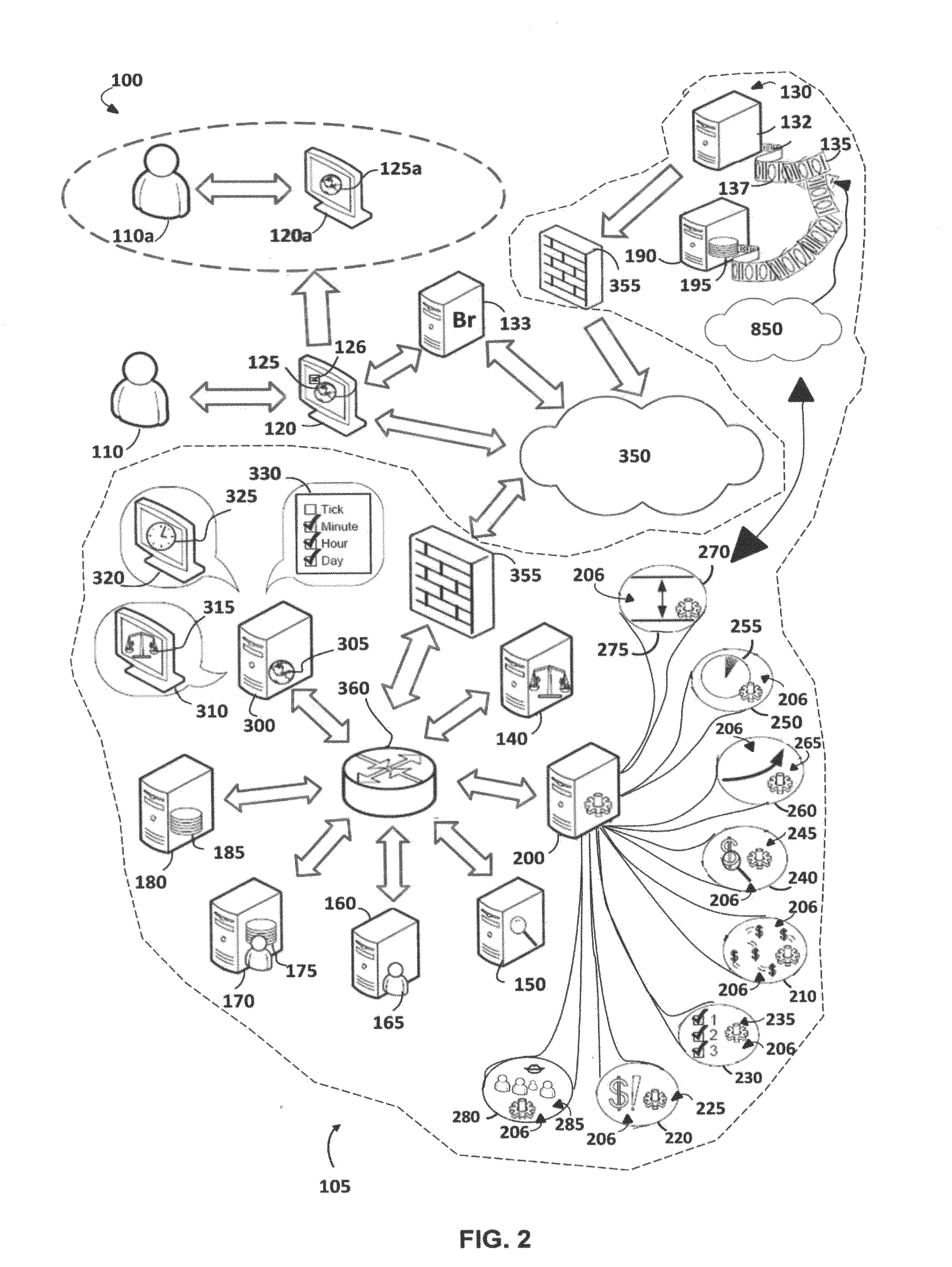

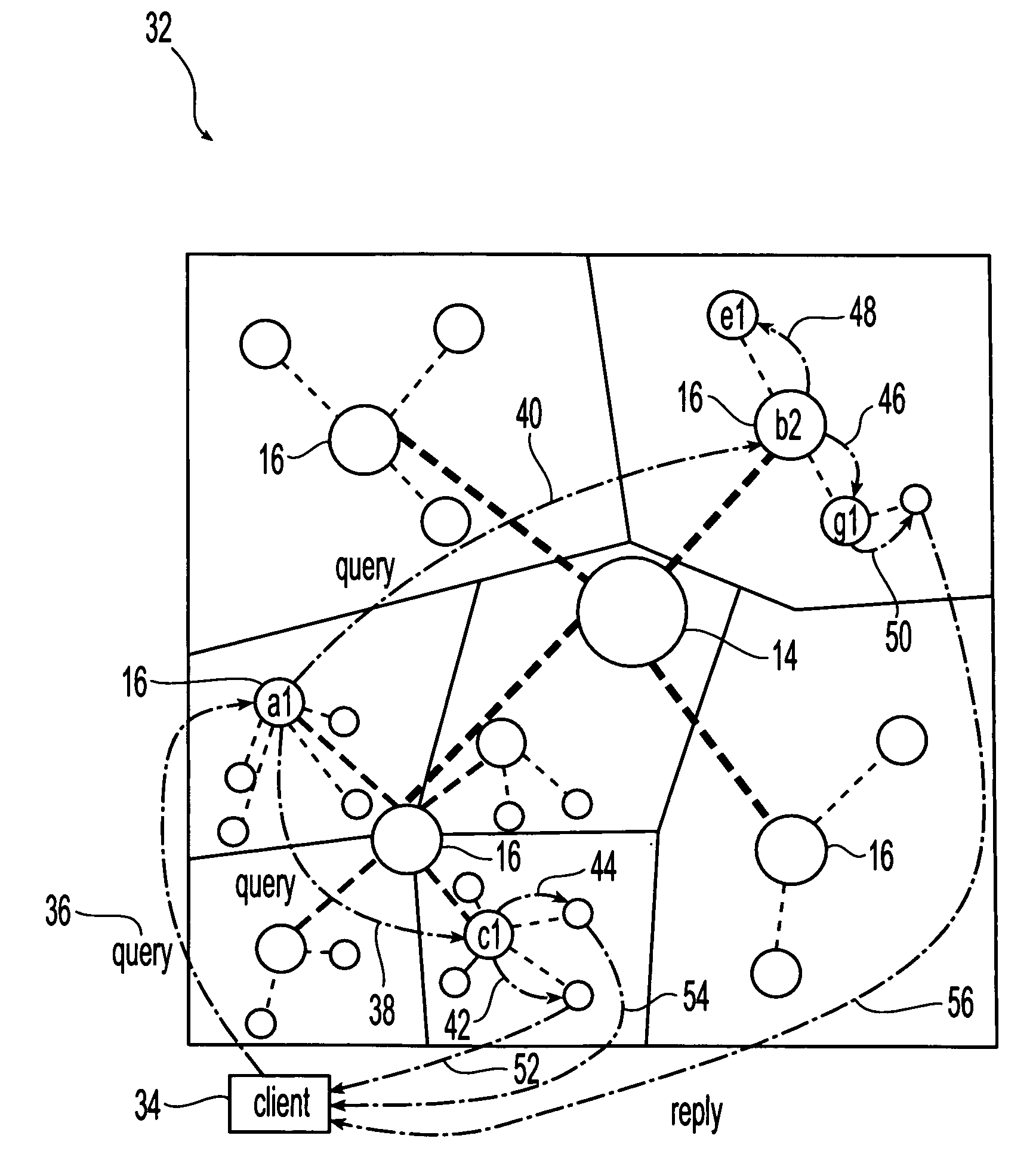

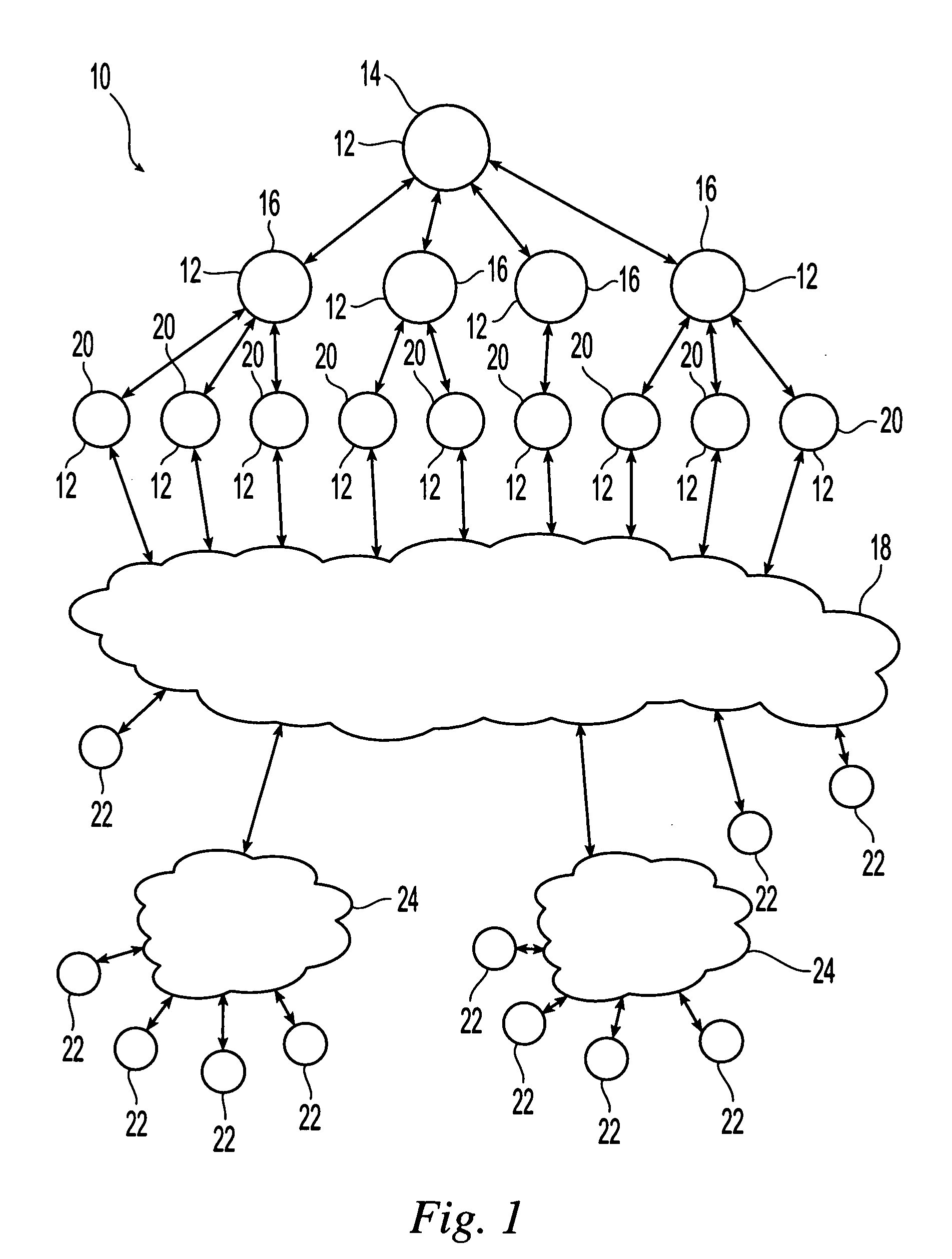

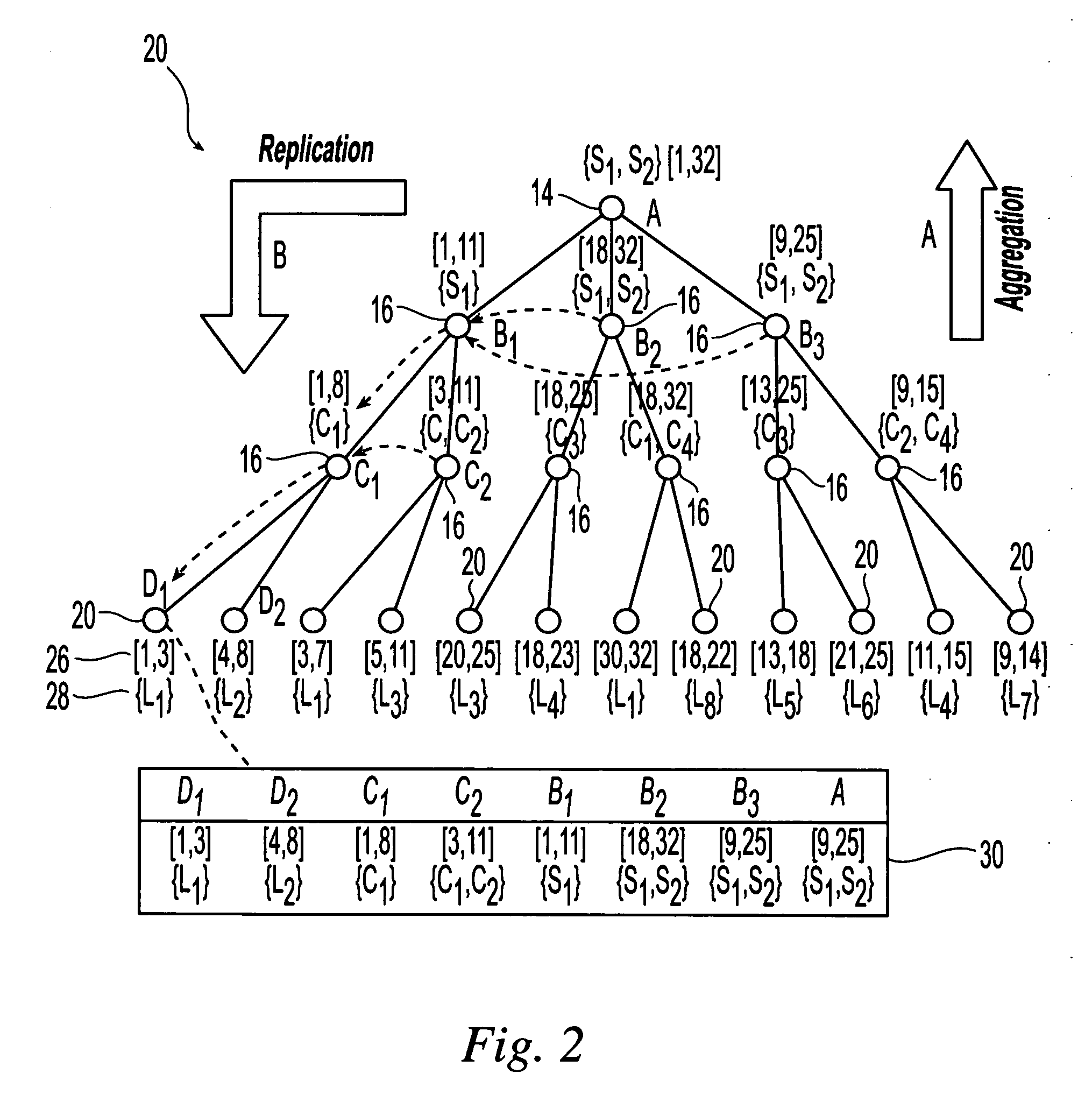

Method and system for federated resource discovery service in distributed systems

InactiveUS20070299804A1Fine granularityMinimal overheadDigital data information retrievalDigital data processing detailsComputing systemsData shipping

Methods and systems are provided for identifying and allocating resources disposed within a plurality of distributed and autonomous computing systems, each of which may have its own legacy resource discovery service. Resource identification servers disposed within each one of the distributed computing systems communicate resource attribute data to a tree hierarchy of dedicated servers. The resource attribute data are maintained in native formats within the distributed computing systems and are mapped to a common format provided by the dedicated servers. The resource attribute data are aggregated at each node within the tree hierarchy, communicated up through the tree hierarchy to one or more root nodes and replicated down through all of the nodes. Additional system robustness is provided through period resource checks and resource attribute data updates. Resource allocation queries are submitted to any level node within the hierarchy and forwarded to the proper computing system for processing.

Owner:IBM CORP

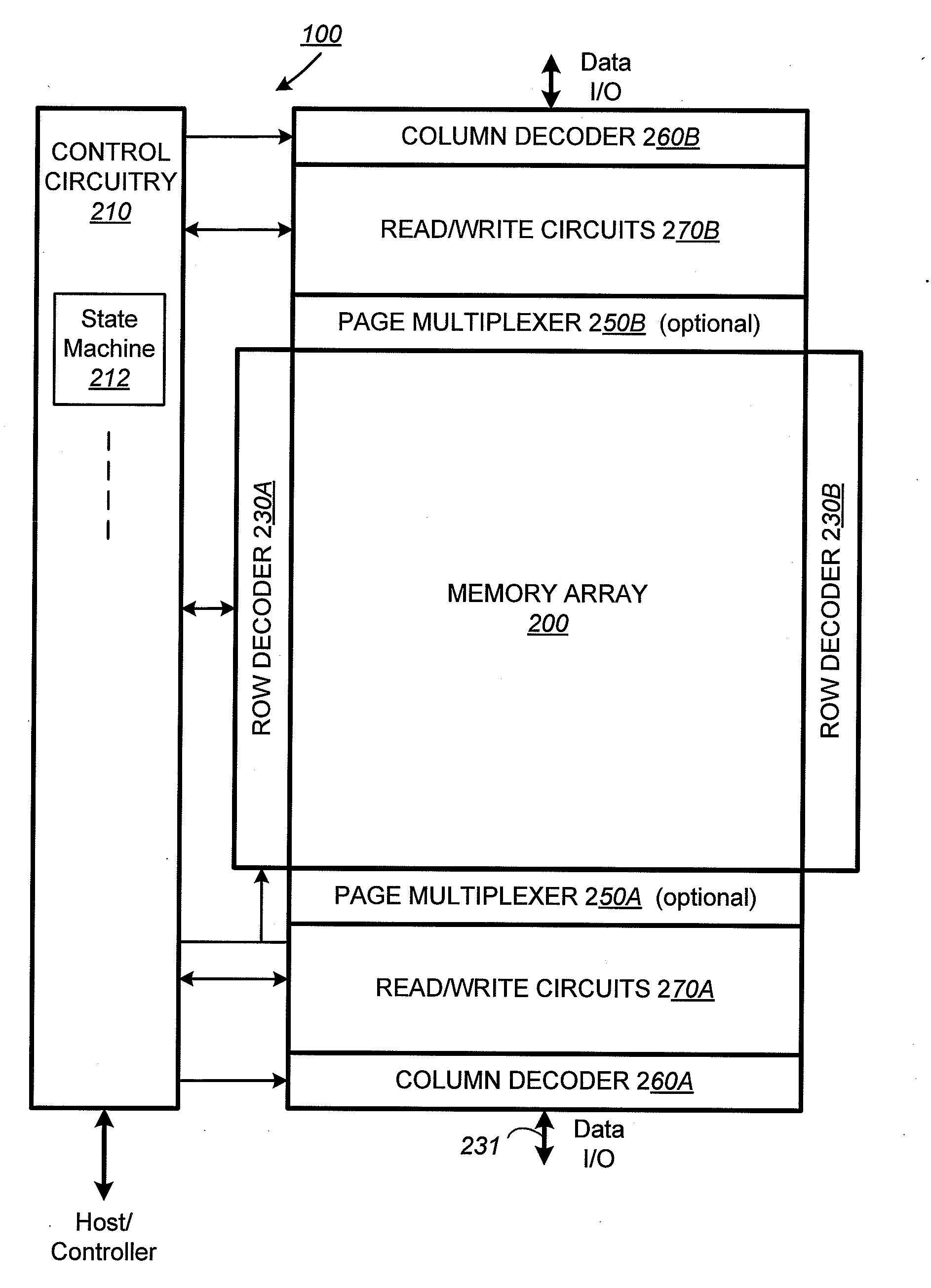

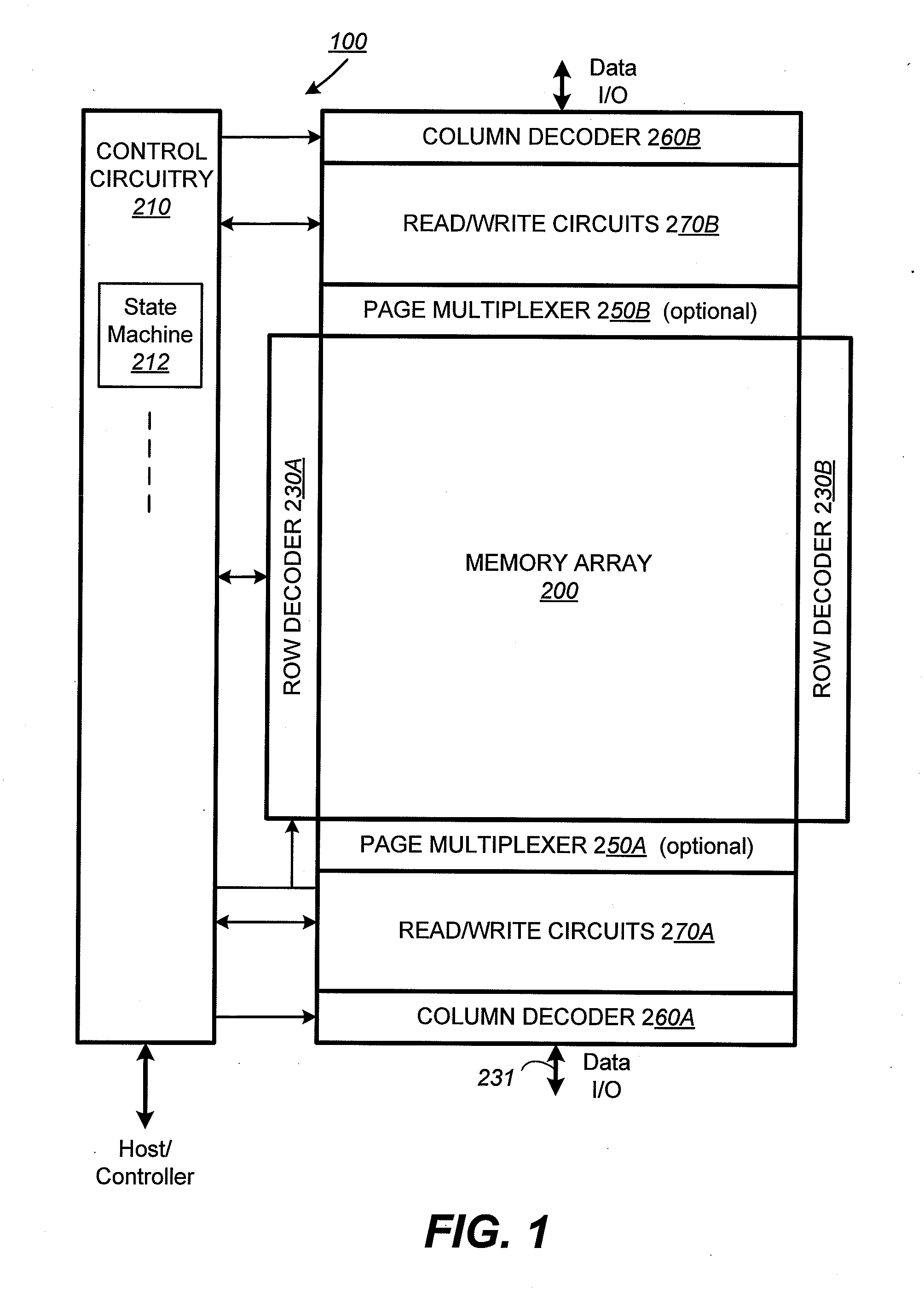

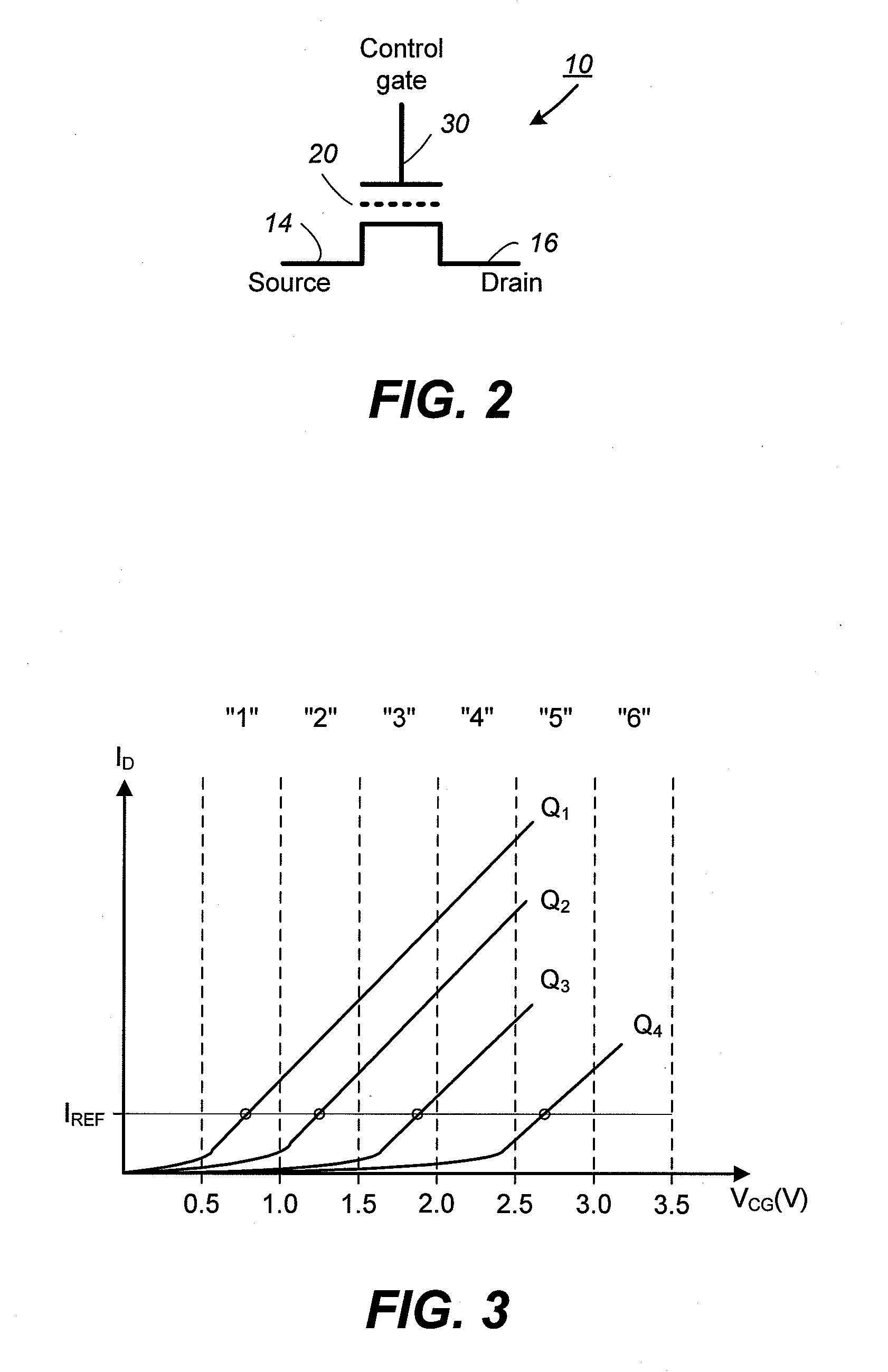

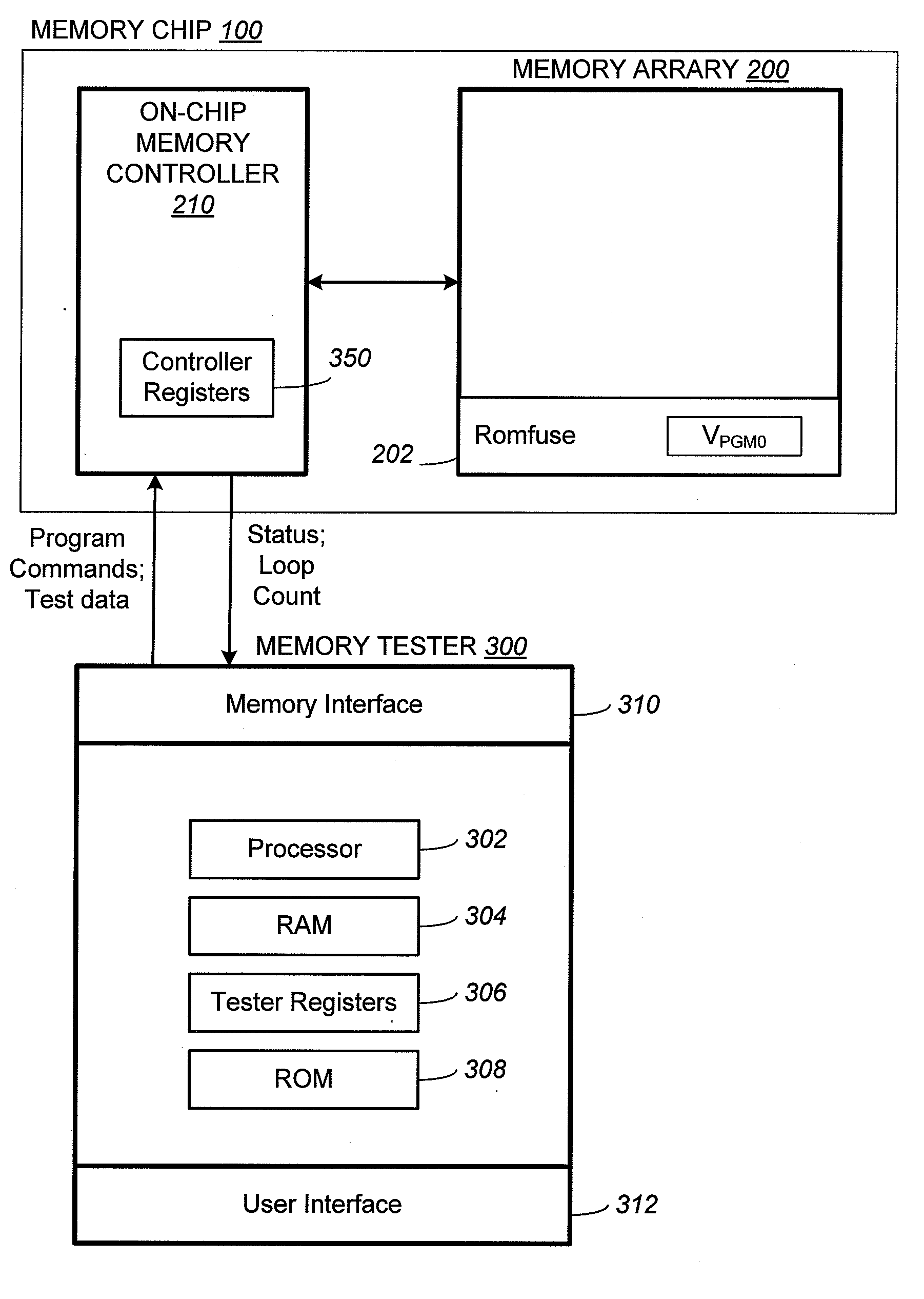

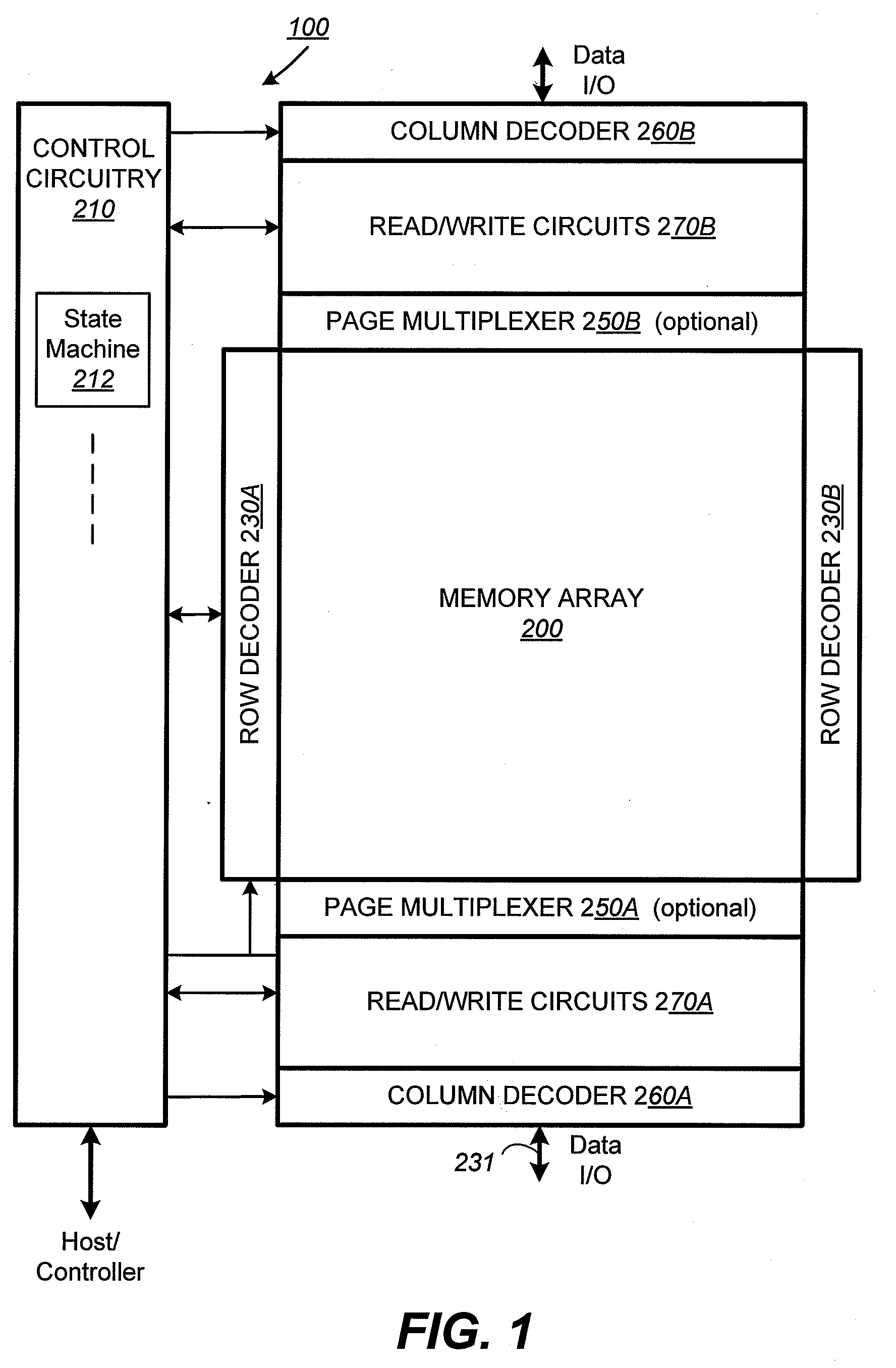

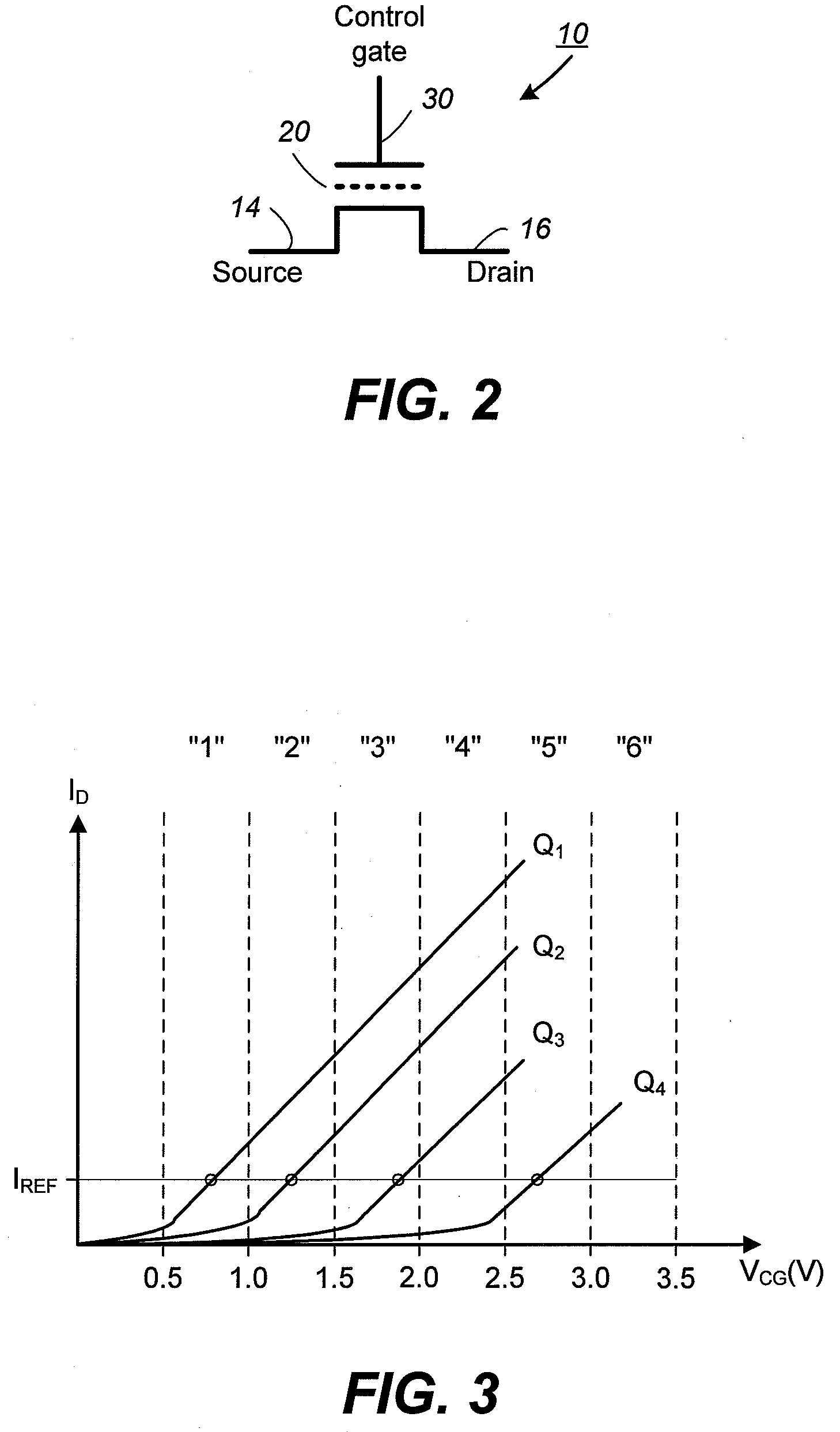

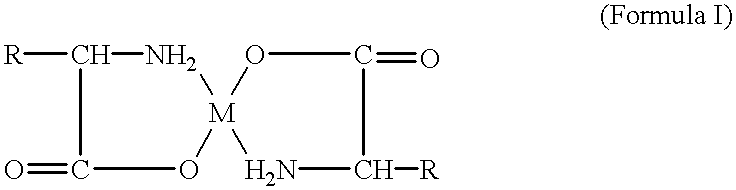

Method for Non-Volatile Memory With Linear Estimation of Initial Programming Voltage

InactiveUS20080062765A1Minimal requirementRead-only memoriesDigital storageVoltage pulseComputer science

In a non-volatile memory, a selected page on a word line is successively programmed by a series of voltage pulses of a staircase waveform with verifications in between the pulses until the page is verified to a designated pattern. The programming voltage at the time the page is programmed verified will be to estimate the initial value of a starting programming voltage for the page. The estimation is further refined by using the estimate from a first pass in a second pass. Also, when the test is over multiple blocks, sampling of word lines based on similar geometrical locations of the blocks can yield a starting programming voltage optimized for faster programming pages.

Owner:WODEN TECH INC

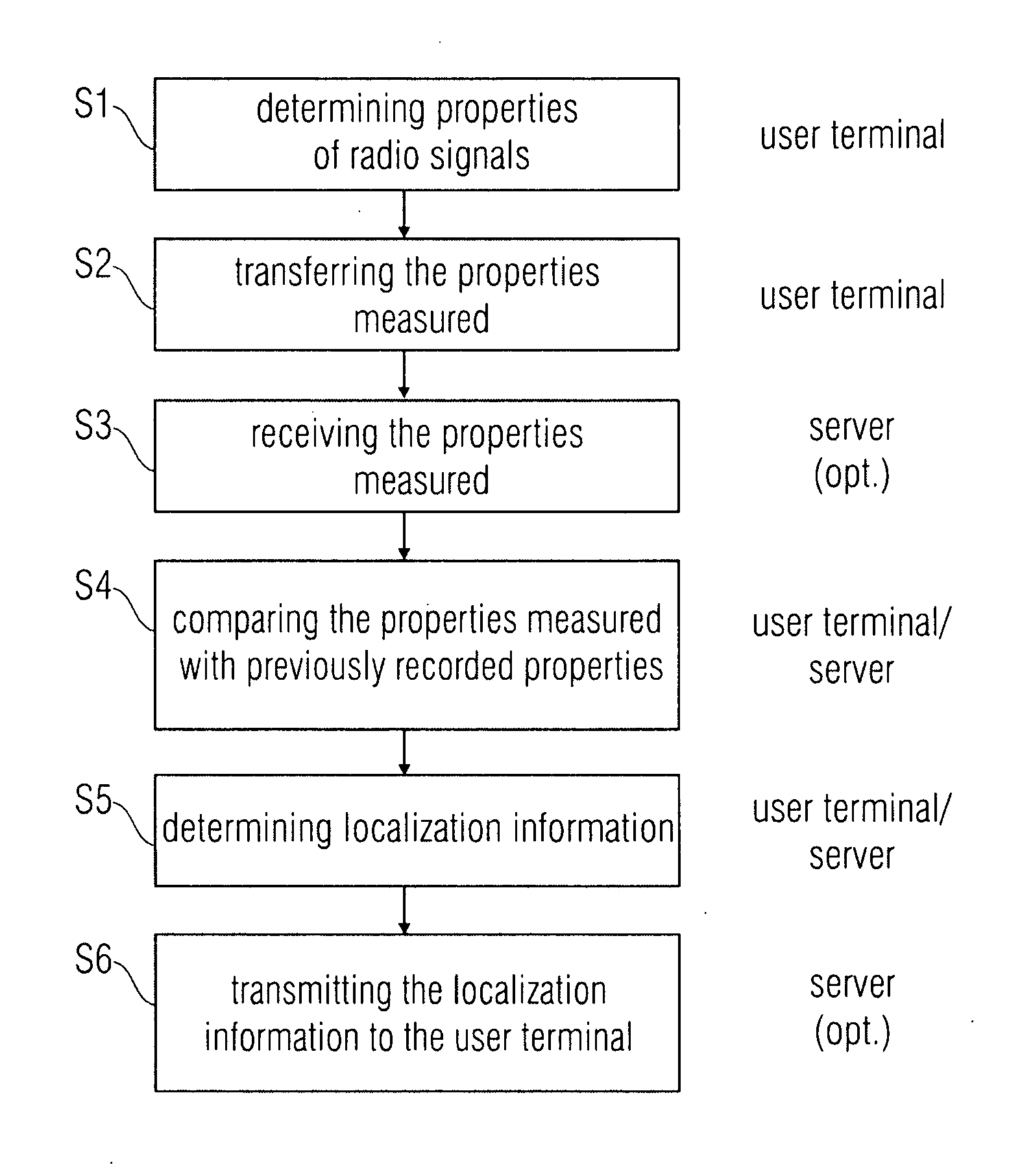

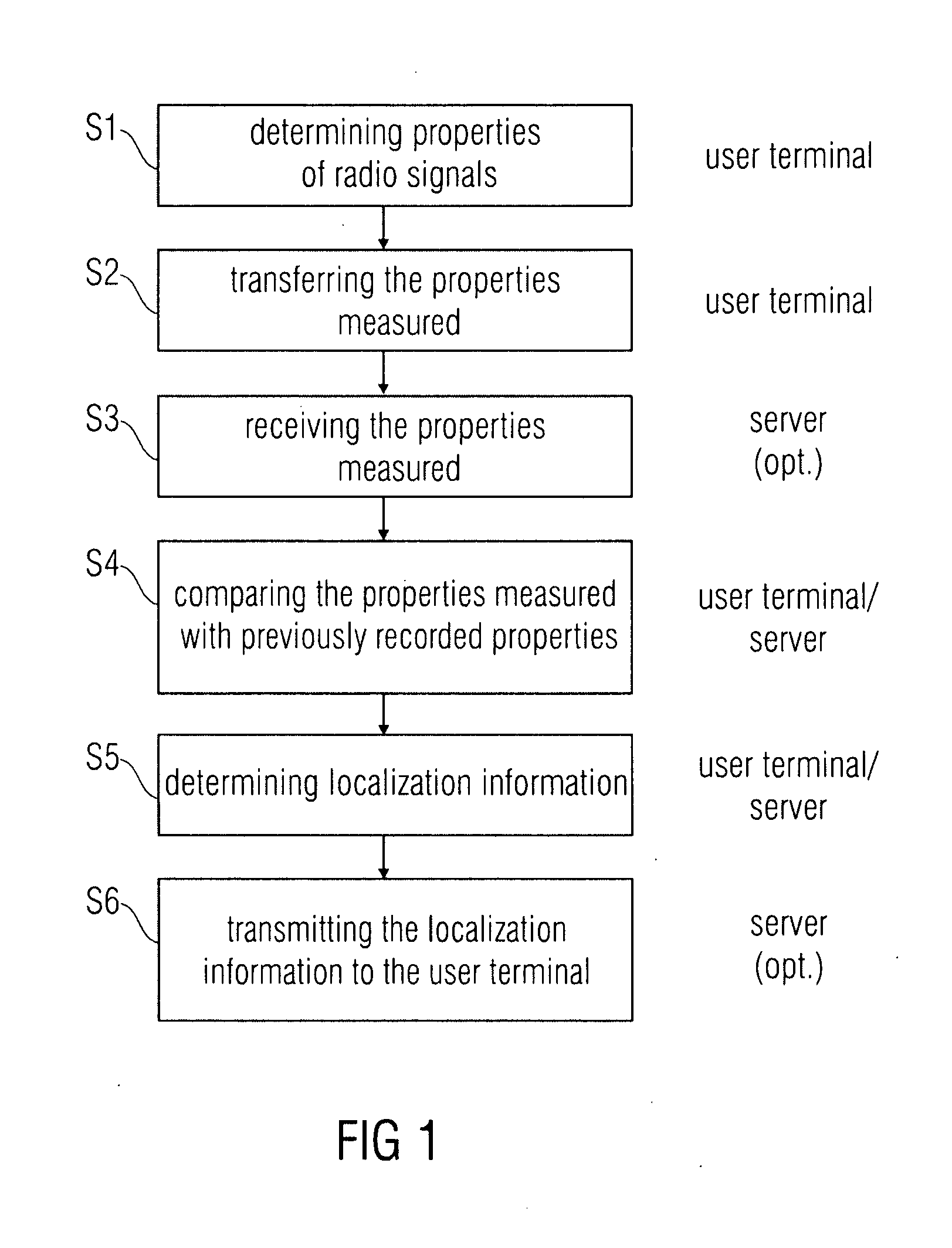

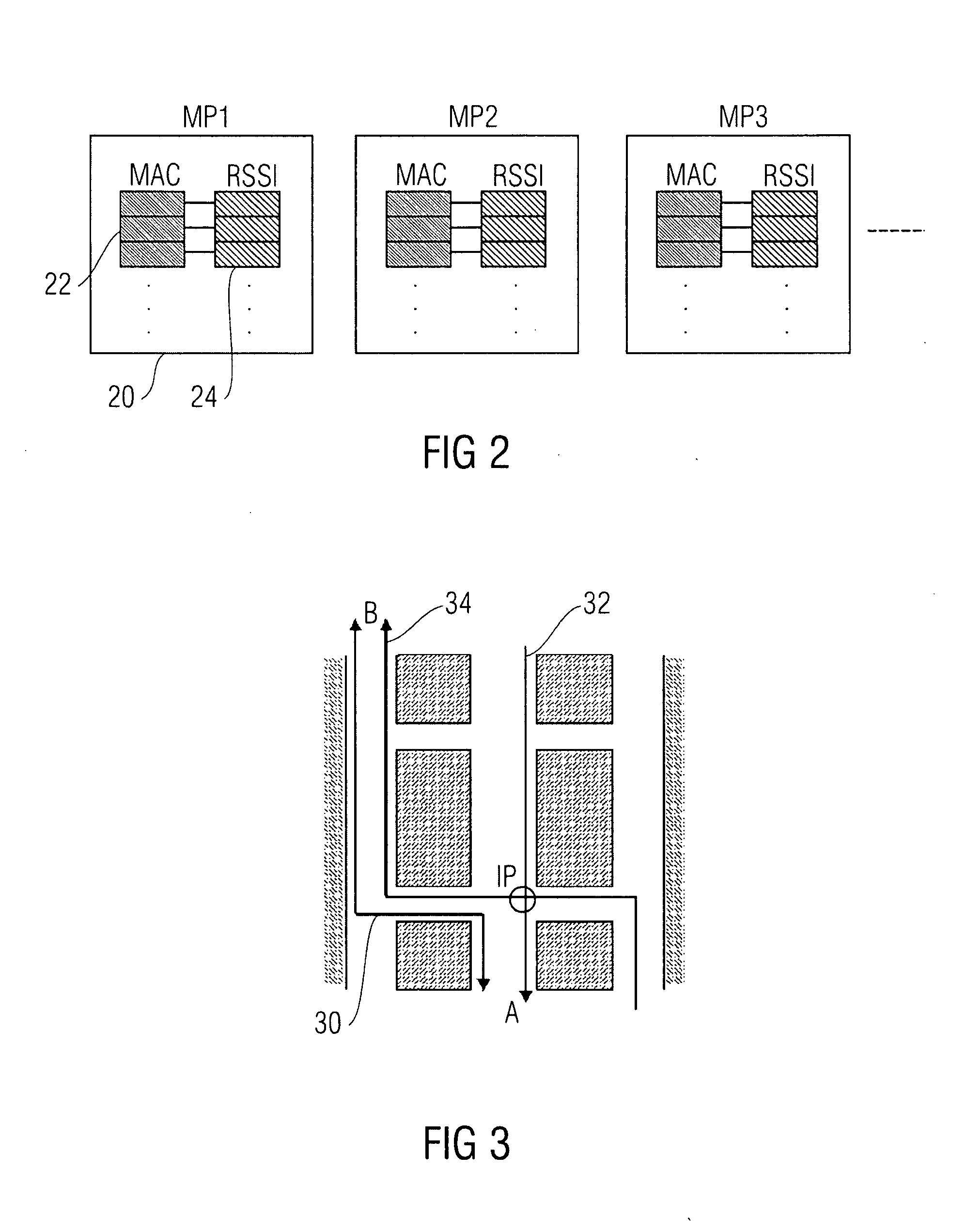

Concept for localizing a position on a path

ActiveUS20100097269A1Easy to understandLittle technical experienceRadio wave direction/deviation determination systemsPosition fixationRadiotransmitterEngineering

An apparatus for localizing a position on a path, radio signals of fixedly positioned radio transmitters being receivable along the path, the apparatus including a determiner for determining properties of the radio signals of the fixedly positioned radio transmitters at the position, and a comparator for comparing the determined electromagnetic properties with previously recorded properties which characterize a reference path, and for determining a relation between the position and the reference path on the basis of a result of the comparison.

Owner:FRAUNHOFER GESELLSCHAFT ZUR FOERDERUNG DER ANGEWANDTEN FORSCHUNG EV

Multimodal unification of articulation for device interfacing

InactiveUS8352260B2Large vocabularyMinimal requirementSpeech recognitionControl signalApplication software

A system for a multimodal unification of articulation includes a voice signal modality to receive a voice signal, and a control signal modality which receives an input from a user and generates a control signal from the input which is selected from predetermined inputs directly corresponding to the phonetic information. The interactive voice based phonetic input system also includes a multimodal integration system to receive and integrates the voice signal and the control signal. The multimodal integration system delimits a context of a spoken utterance of the voice signal by using the control signal to preprocess and discretize into phonetic frames. A voice recognizer analyzing the voice signal integrated with the control signal to output a voice recognition result. This new paradigm helps overcome constraints found in interfacing mobile devices. Context information facilitates the handling of the commands in the application environment.

Owner:SUNG JUN HYUNG

Non-Volatile Memory With Linear Estimation of Initial Programming Voltage

ActiveUS20080062770A1Minimal requirementRead-only memoriesDigital storageVoltage pulseComputer science

In a non-volatile memory, a selected page on a word line is successively programmed by a series of voltage pulses of a staircase waveform with verifications in between the pulses until the page is verified to a designated pattern. The programming voltage at the time the page is programmed verified will be to estimate the initial value of a starting programming voltage for the page. The estimation is further refined by using the estimate from a first pass in a second pass. Also, when the test is over multiple blocks, sampling of word lines based on similar geometrical locations of the blocks can yield a starting programming voltage optimized for faster programming pages.

Owner:WODEN TECH INC

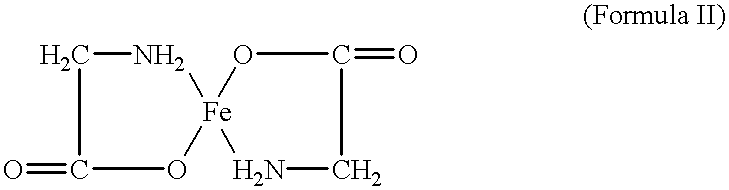

Cereal grain kernels fortified with amino acid chelates and method of making

InactiveUS6207204B1Improve bioavailabilityMinimal requirementConfectioneryEdible seed preservationZincChelation

A cereal grain kernel coated with a metal amino acid chelate, a method for mineral or metal fortification of cereal grain kernels and a coating composition is disclosed. Unlike other metal or mineral fortificants, cereal grain kernels may be coated with iron, calcium, zinc and / or other metals in the form of an amino acid chelate without pulverizing individual kernels. Further, the coated kernels are stable, palatable and contain highly bioavailable metals.

Owner:ALBION LAB

Double bag vacuum infusion process and system for low cost, advanced composite fabrication

Boeing is actively engaged in the production of lightweight composite airframes for both military and commercial applications. The double bag vacuum infusion process of the present invention provides a low cost, method for producing complex composite assemblies without an autoclave. It also enables the production of highly innovative structures. The quality of the composites produced using such an infusion process are comparable to composites made using prepregs, hand layup or fiber placement and autoclave curing.

Owner:THE BOEING CO

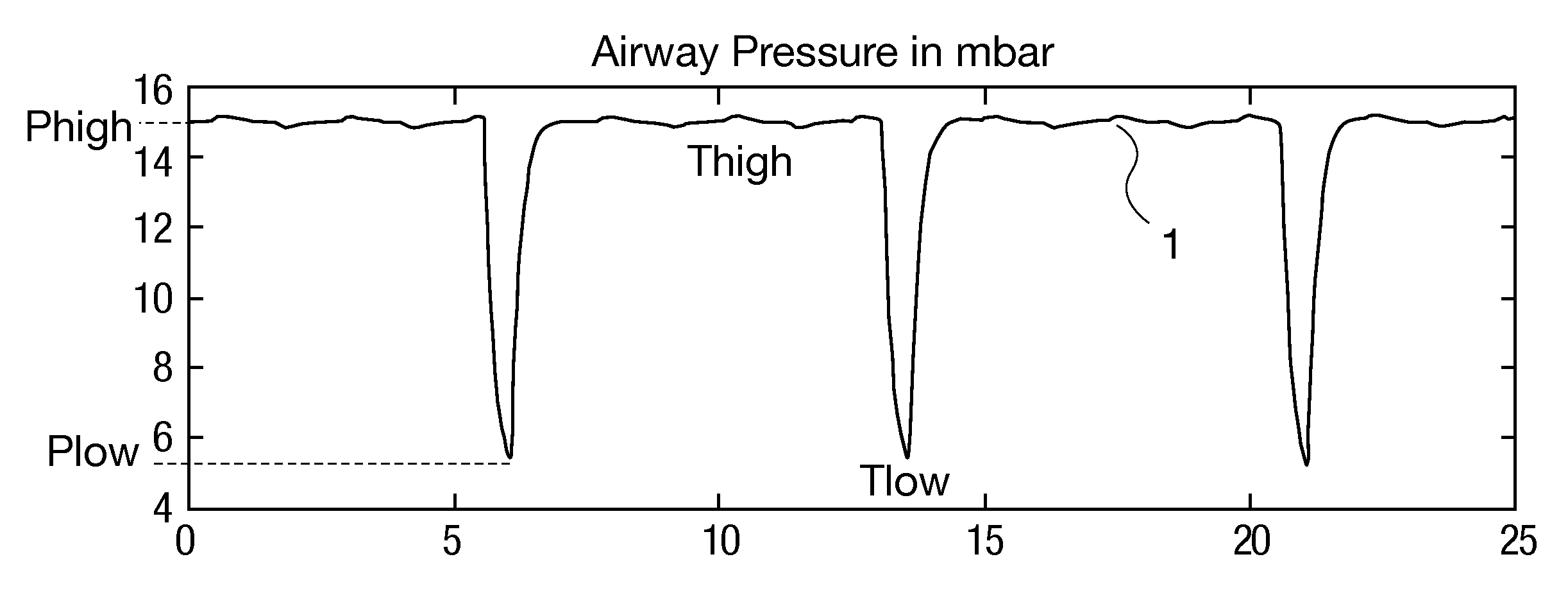

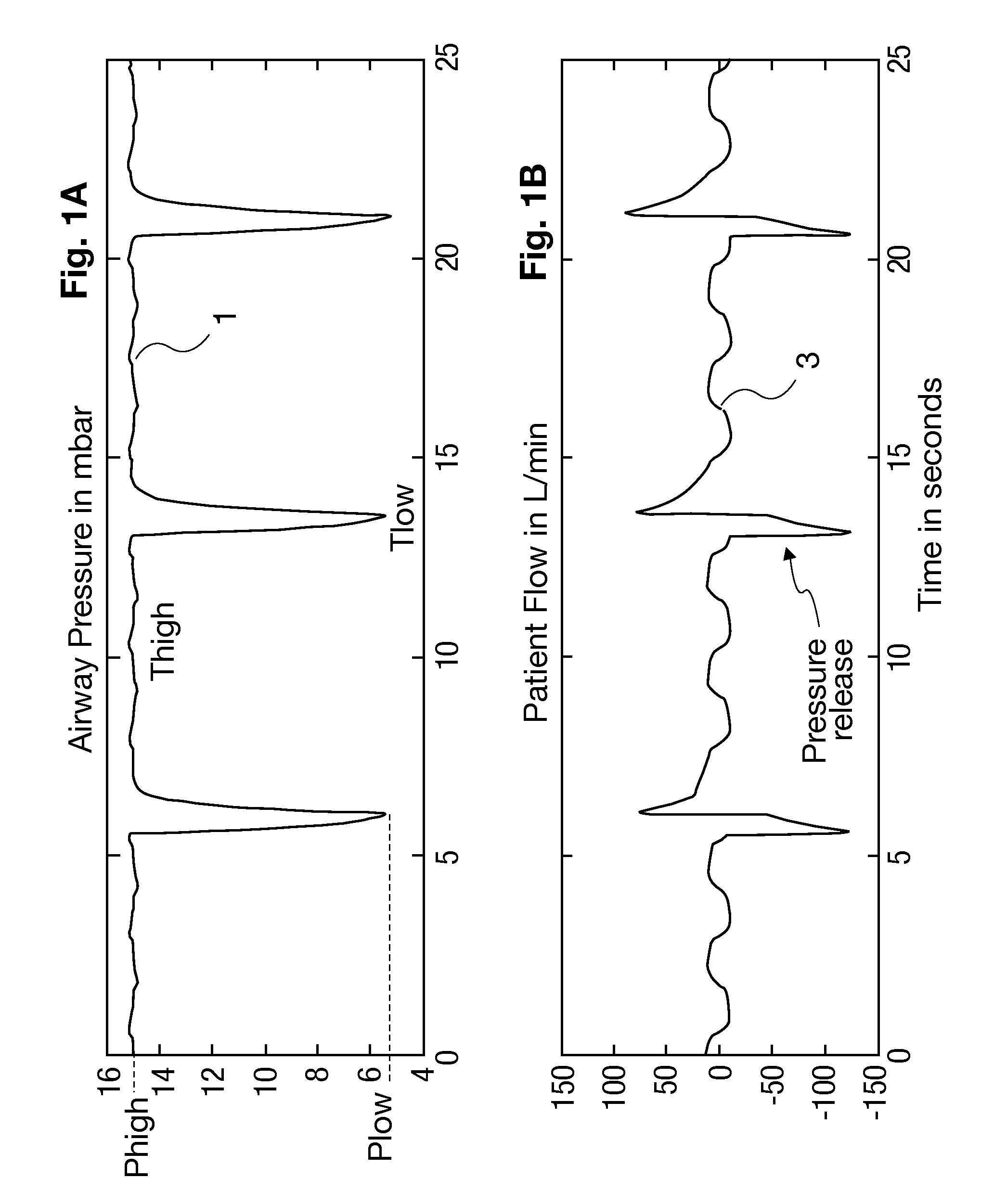

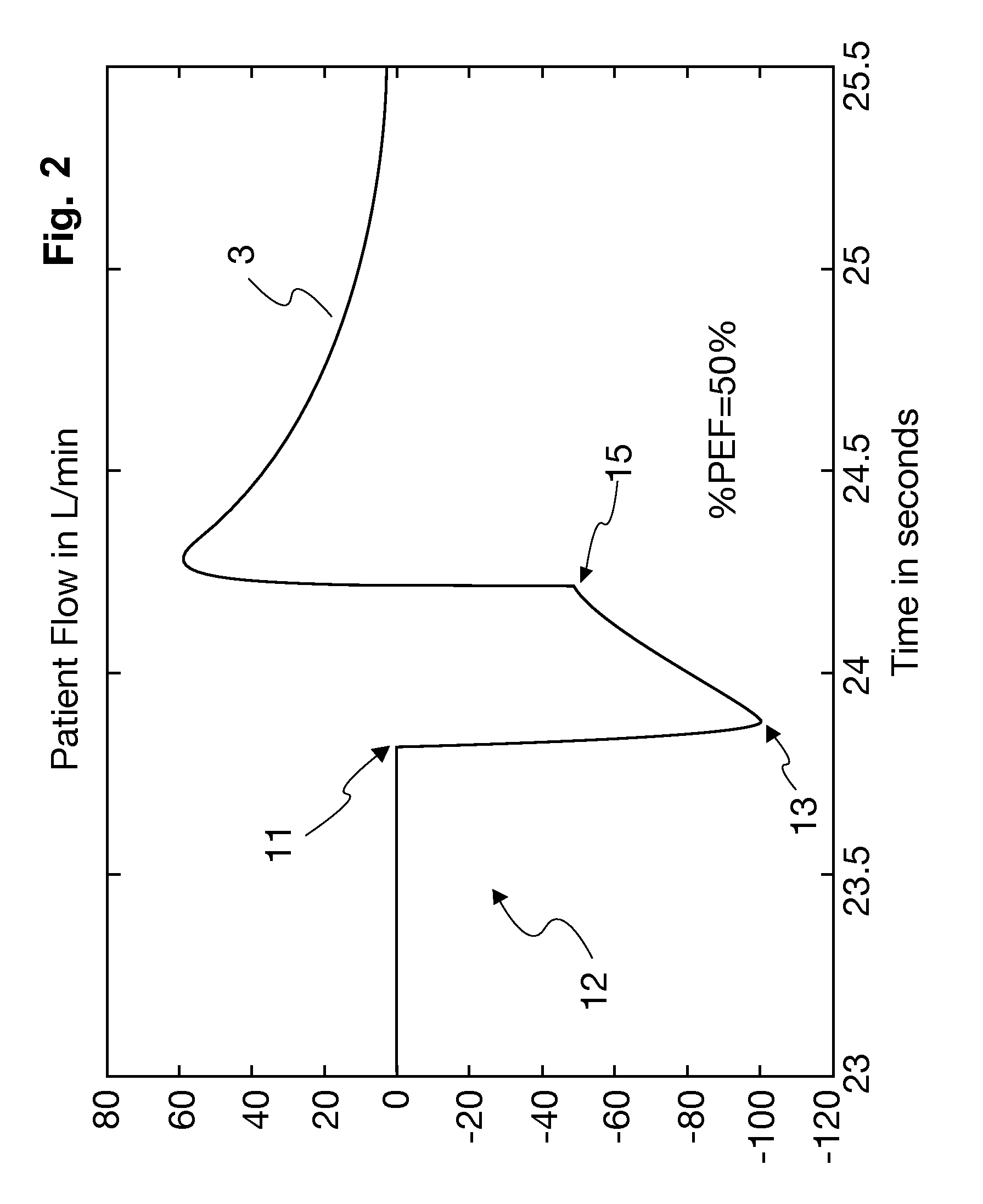

Process for operating a respirator and/or anesthesia device in the aprv mode with the %pef criterion and a device operated correspondingly

ActiveUS20080295840A1Prolong inspiration timeIncrease oxygenationRespiratorsOperating means/releasing devices for valvesEngineeringAnesthesia device

A process for operating a respirator and / or anesthesia device in the APRV mode with the % PEF criterion which includes a detection of a spontaneous expiratory effort by the patient and initiation of a pressure release phase when the detected spontaneous expiratory effort by the patient falls within a predetermined trigger window (Tfreg). A device is provided that is operated correspondingly.

Owner:DRAGERWERK AG

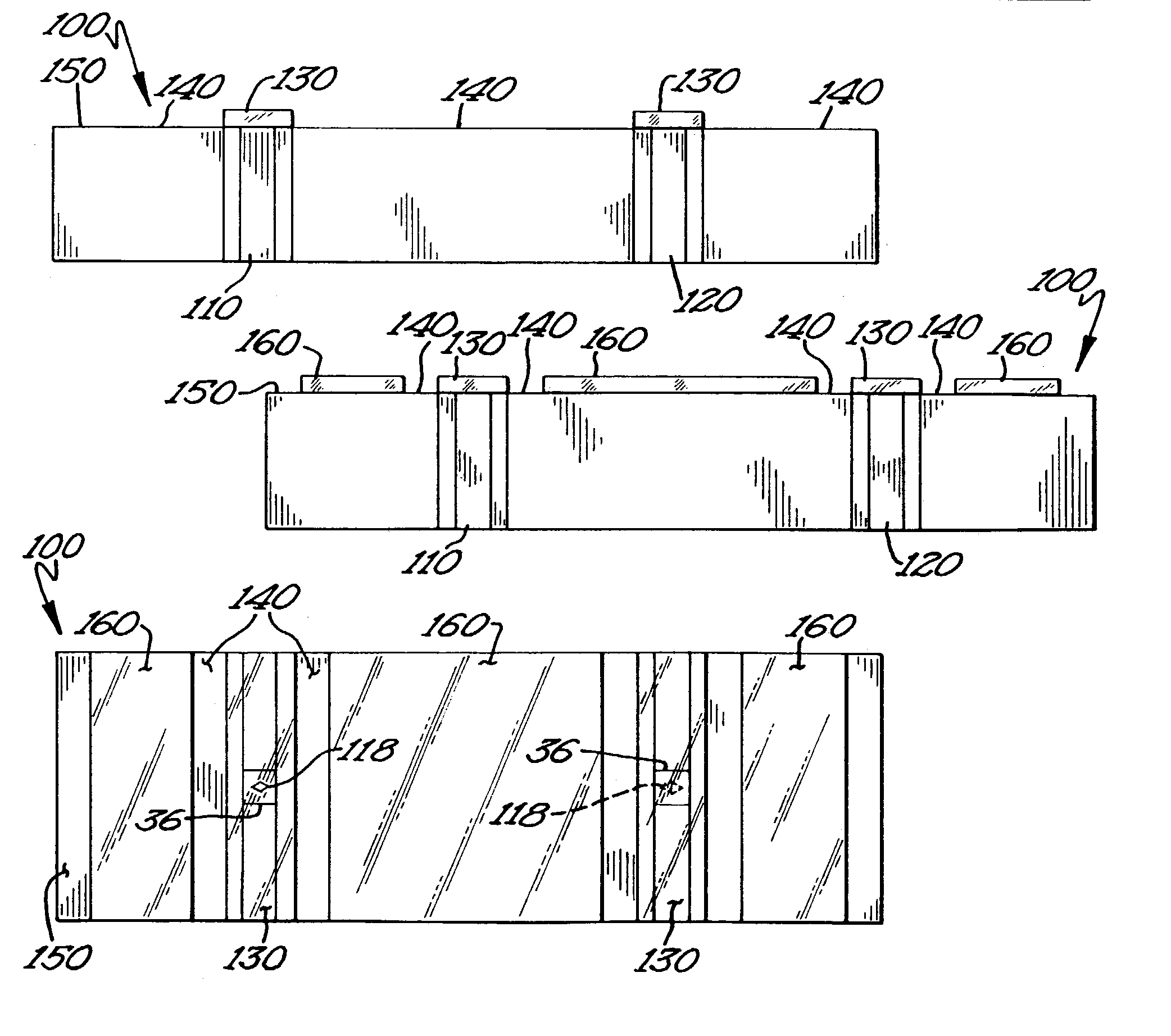

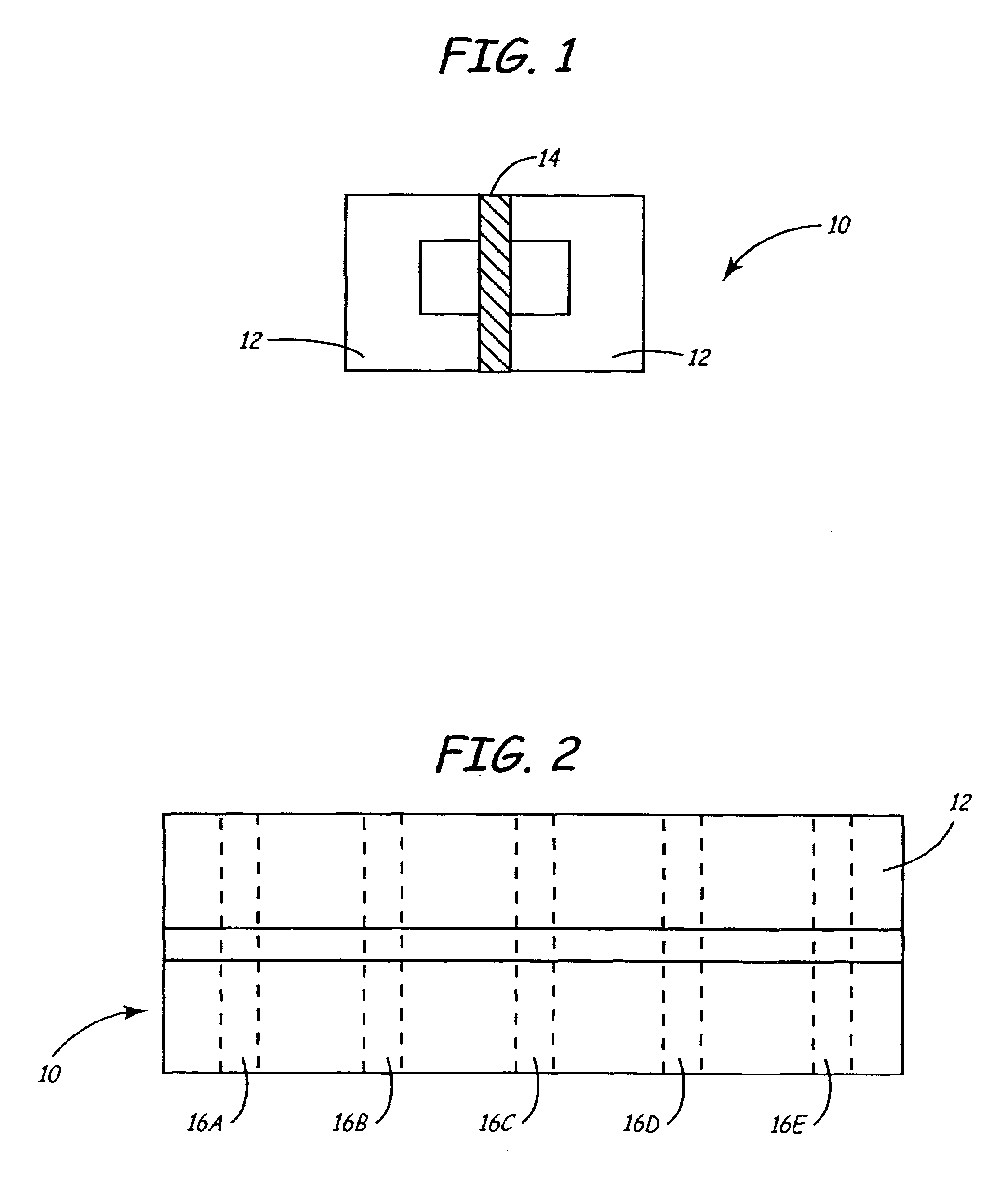

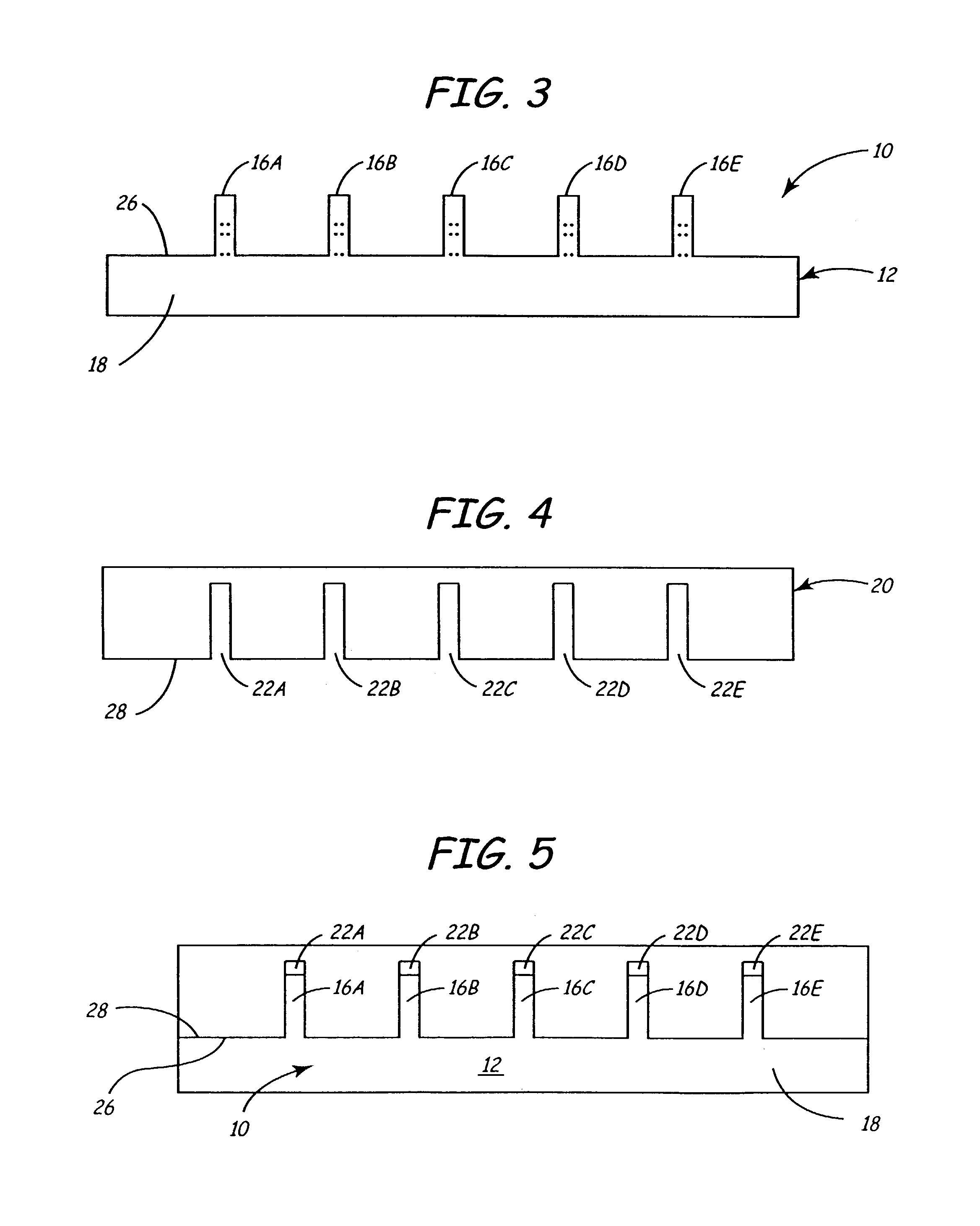

Wear pads for timing-based surface film servo heads

InactiveUS6989960B2Avoid negative effectsQuick wearElectrical transducersManufacture head surfaceEngineeringBearing surface

A thin film magnetic recording head is provided with a tape bearing surface that has magnetically isolated channels while still providing a maximum continuous surface area with which to engage the media. This can be accomplished by providing spaces in the magnetically permeable thin film that are large enough to prevent cross-talk between the channels, but small enough to prevent significant interference with the moving media. Alternatively, magnetically impermeable thin film spacers can be provided to magnetically isolate each of the channels. The spacers are generally even with the magnetically permeable thin film so as to provide a continuous media-bearing surface.

Owner:ADVANCED RES

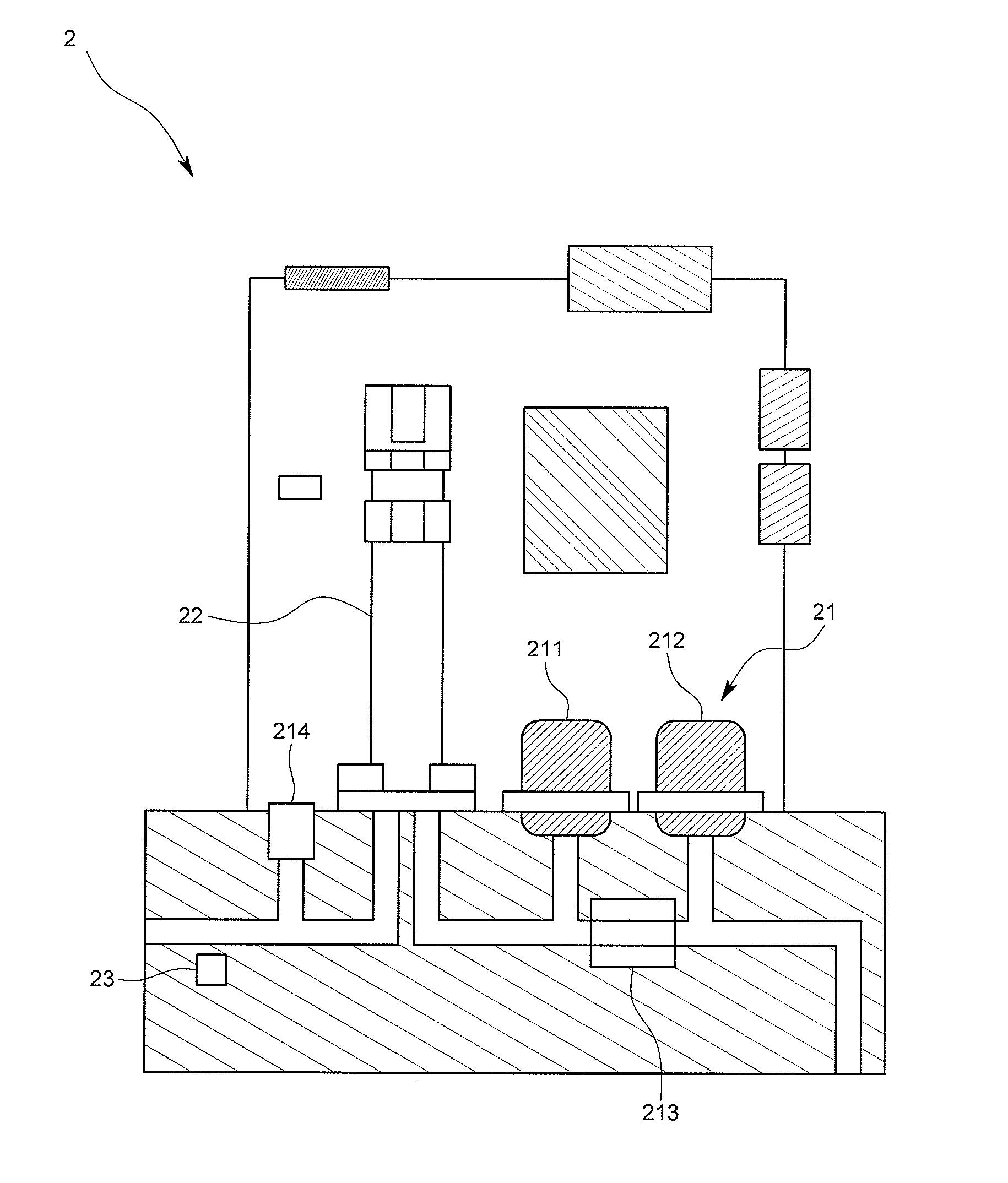

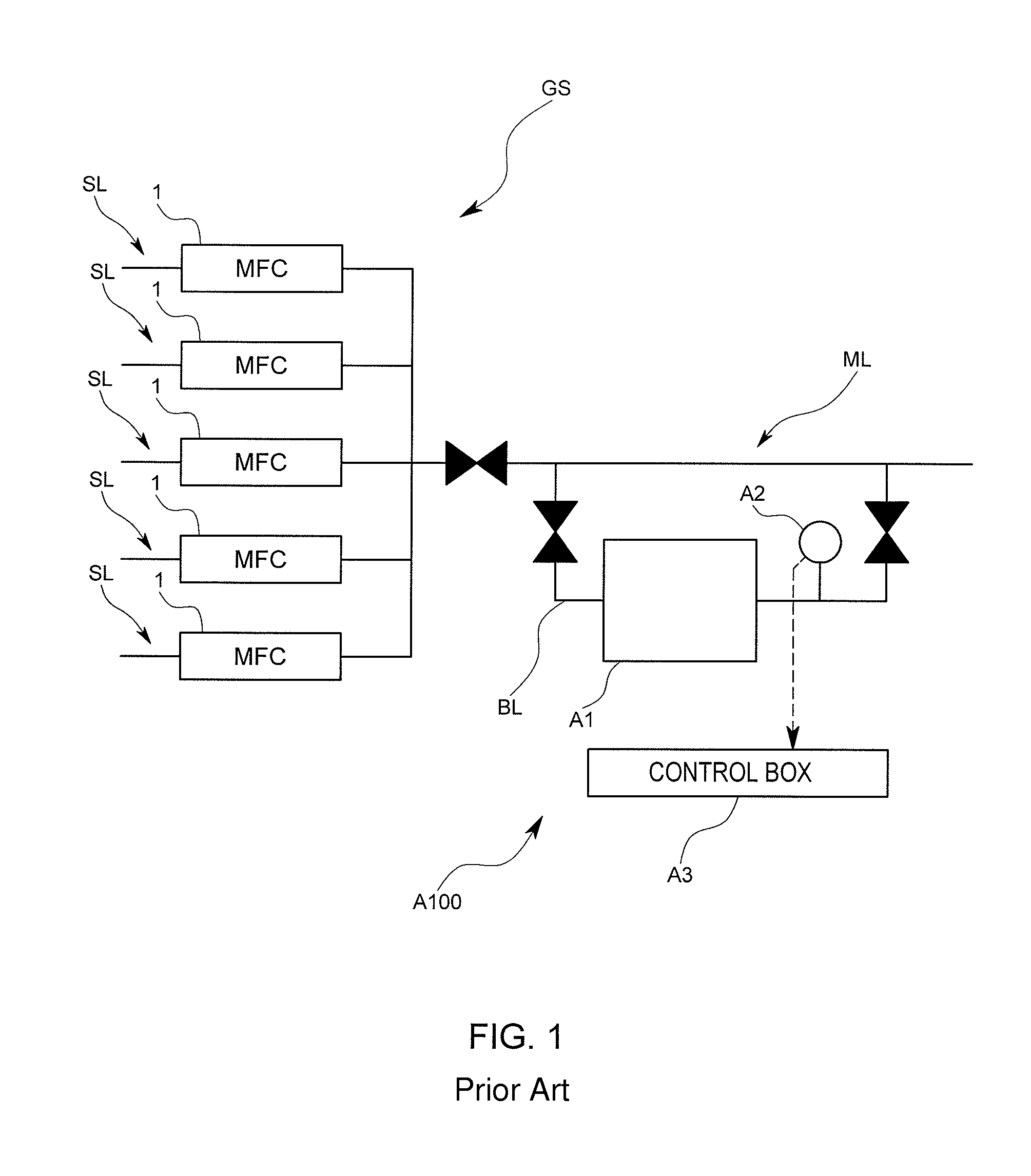

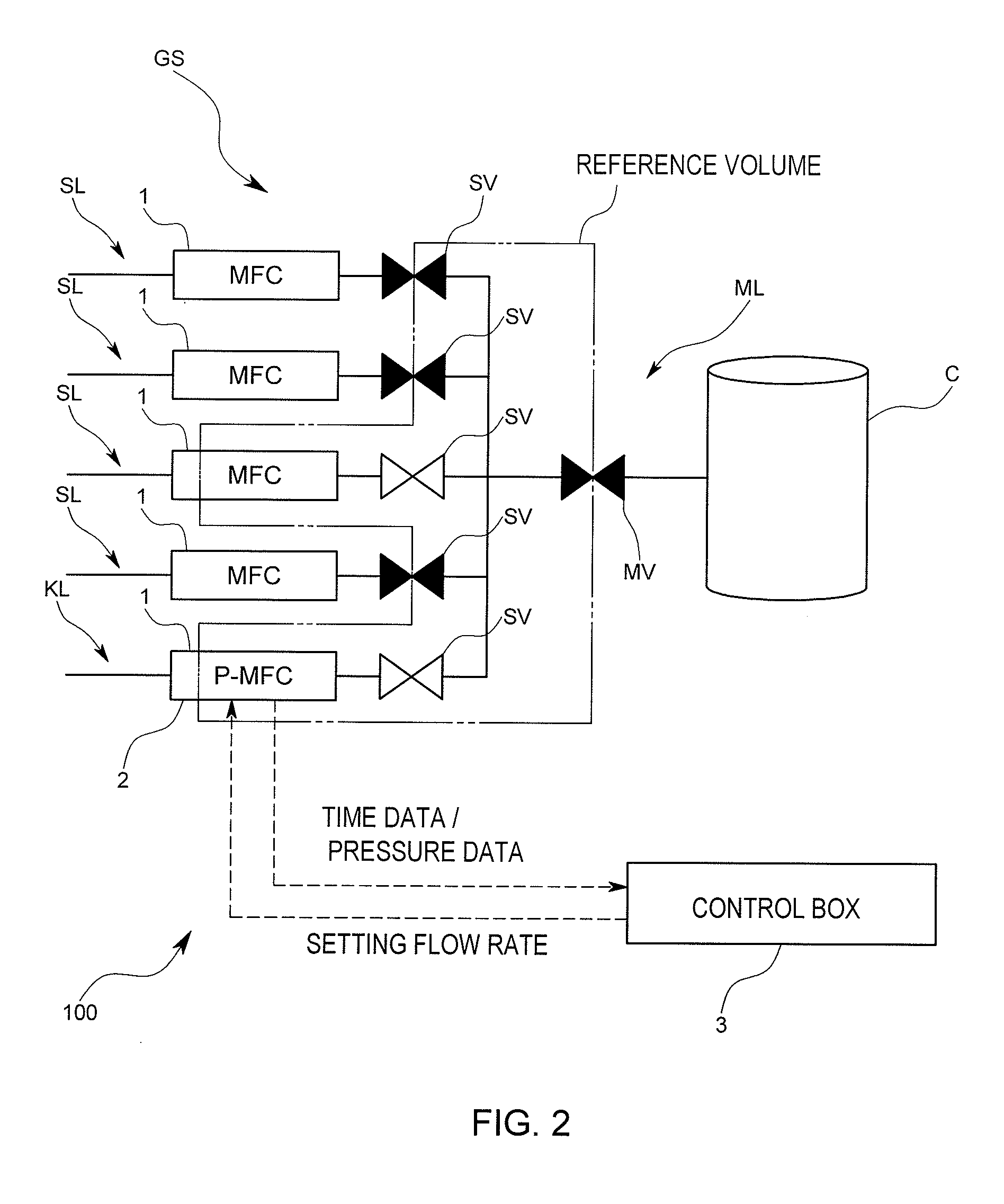

Mass flow controller verifying system, verifying method and verifying program

InactiveUS20100229967A1Minimized volumeReduce verification timeVehicle testingSemiconductor/solid-state device manufacturingLine tubingValidation methods

In a mass flow controller verifying system, there are provided a verifying gas line arranged in parallel to influent flow gas lines and joined into a post-confluent flow gas line, a reference volume calculating portion adapted to calculate a reference volume determined for a specified piping of a gas piping system, a verifying parameter calculating portion adapted to calculate a verifying parameter based on time series data of a measurement pressure measured by a pressure measurement unit during a control of a flow rate by a mass flow controller to be verified, and a comparing portion adapted to compare a reference parameter set based on the reference volume and the verifying parameter, whereby the verifying system can be introduced into an existing gas piping system used in a semiconductor manufacturing process and so forth at a low cost and is capable of verifying a mass flow controller quickly and accurately.

Owner:HORIBA STEC CO LTD

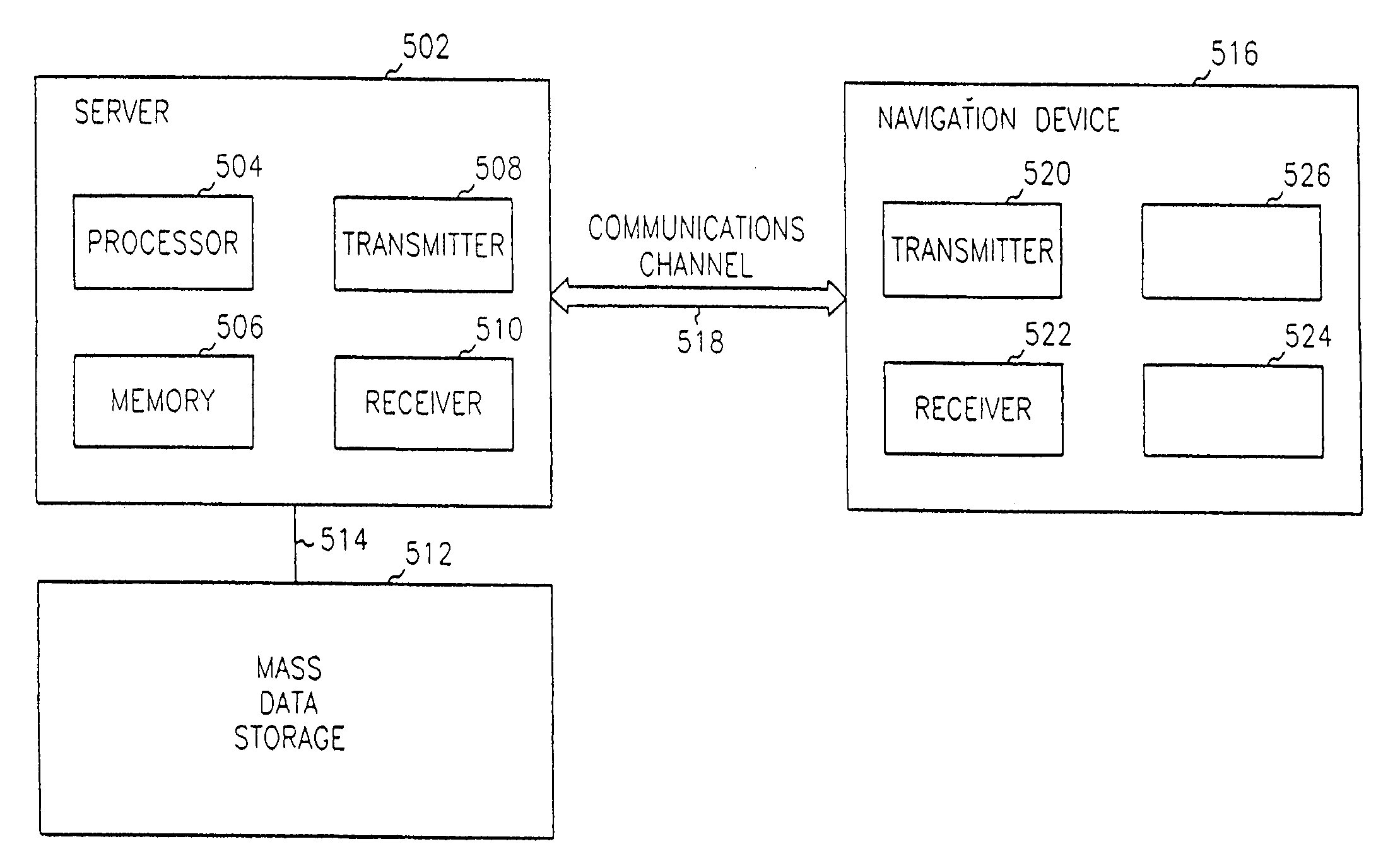

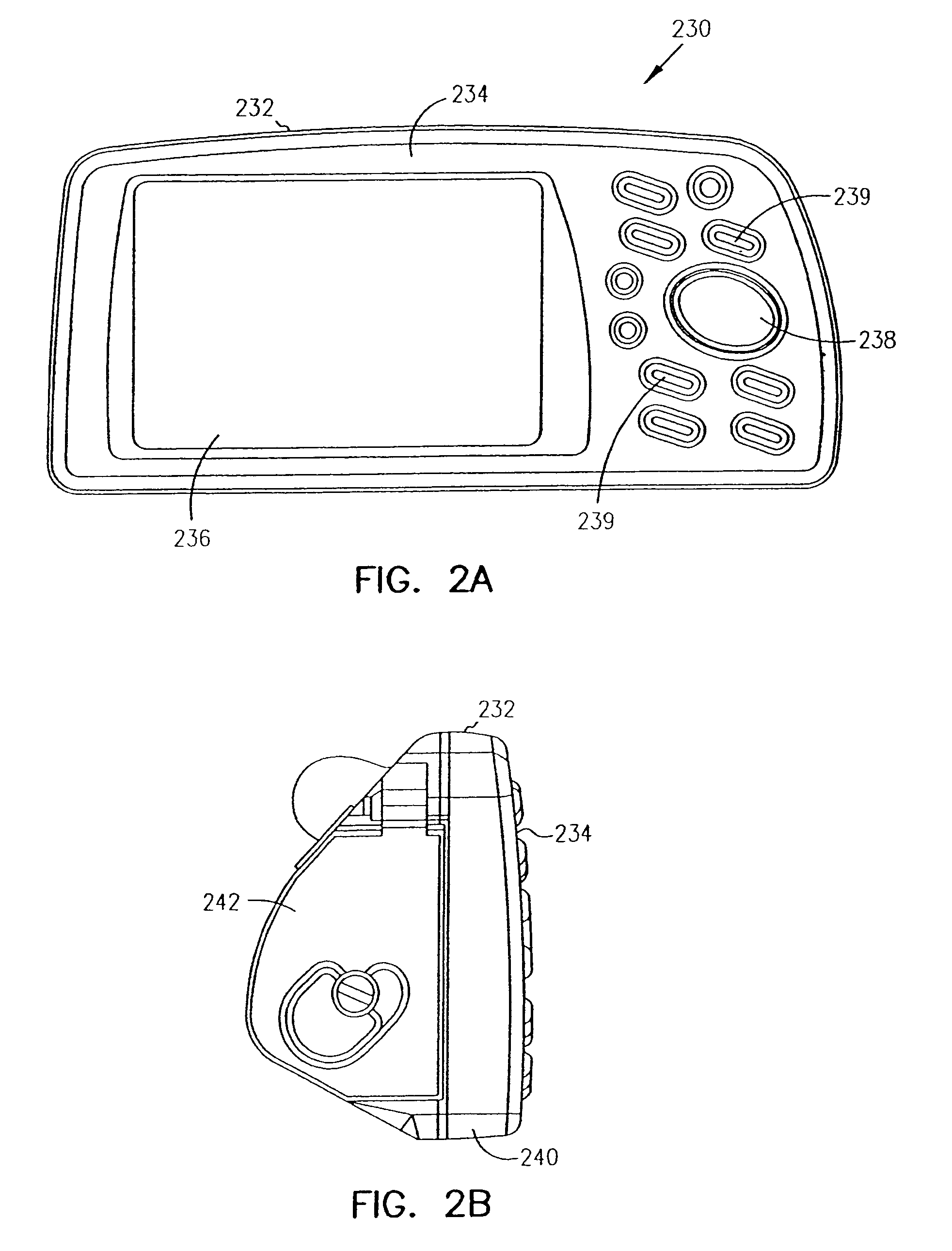

Systems, functional data, and methods for generating a route

InactiveUS6975940B1Increased RAM capacityRapidly and efficiently generatesInstruments for road network navigationNavigational calculation instrumentsLeast costComputer science

Devices, systems, functional data and methods are provided for an improved route generation in navigational enabled devices. In generating the route, the available locations are inspected repetitively and locations adjacent to a last selected location are inserted into a first data structure such that the first location of the first data structure is always a least cost location associated with all adjacent locations comprising the first data structure. The first location is then optionally inserted into a second data structure. The generated route includes the current location, one or more first locations, and the destination.

Owner:GARMIN

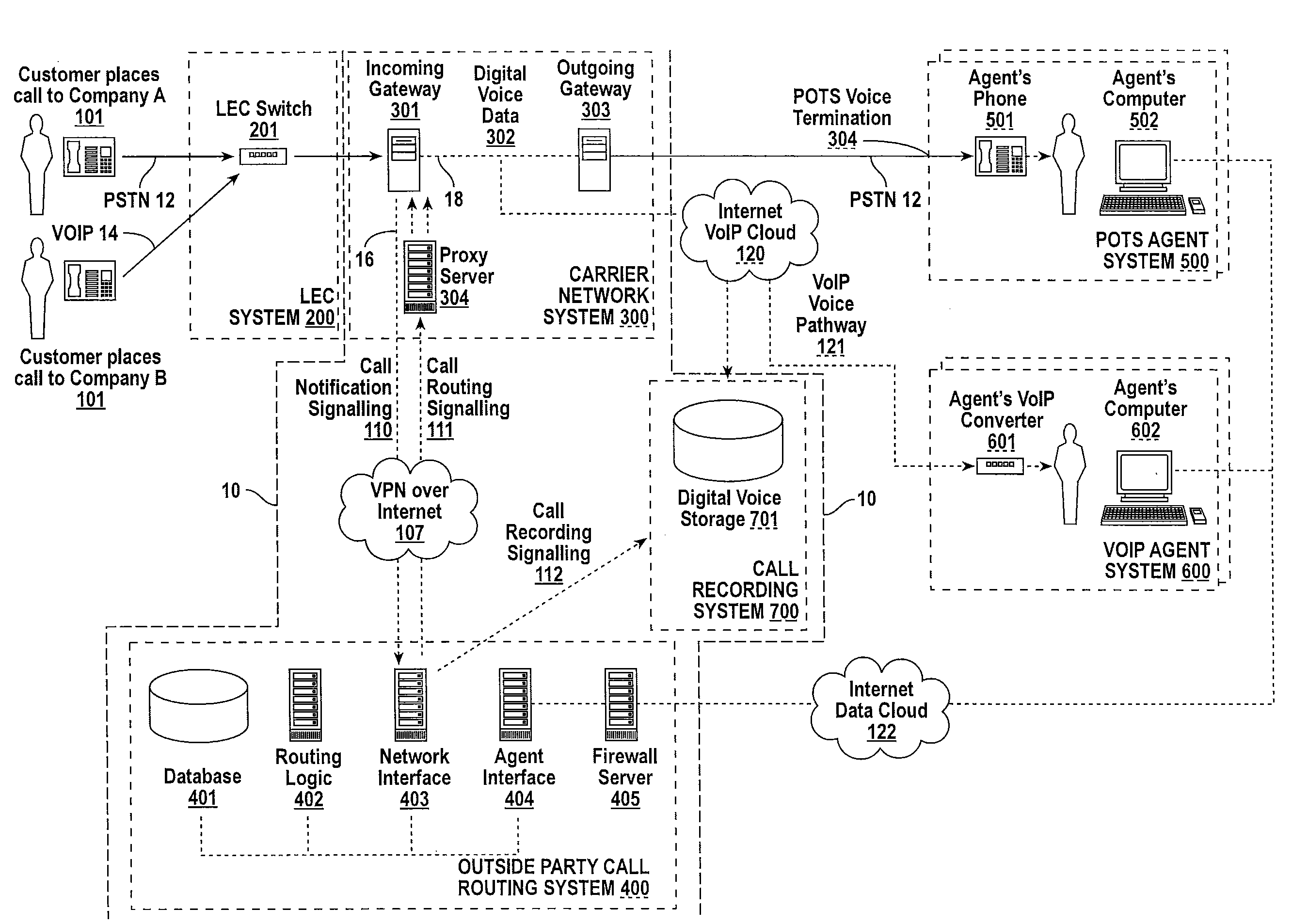

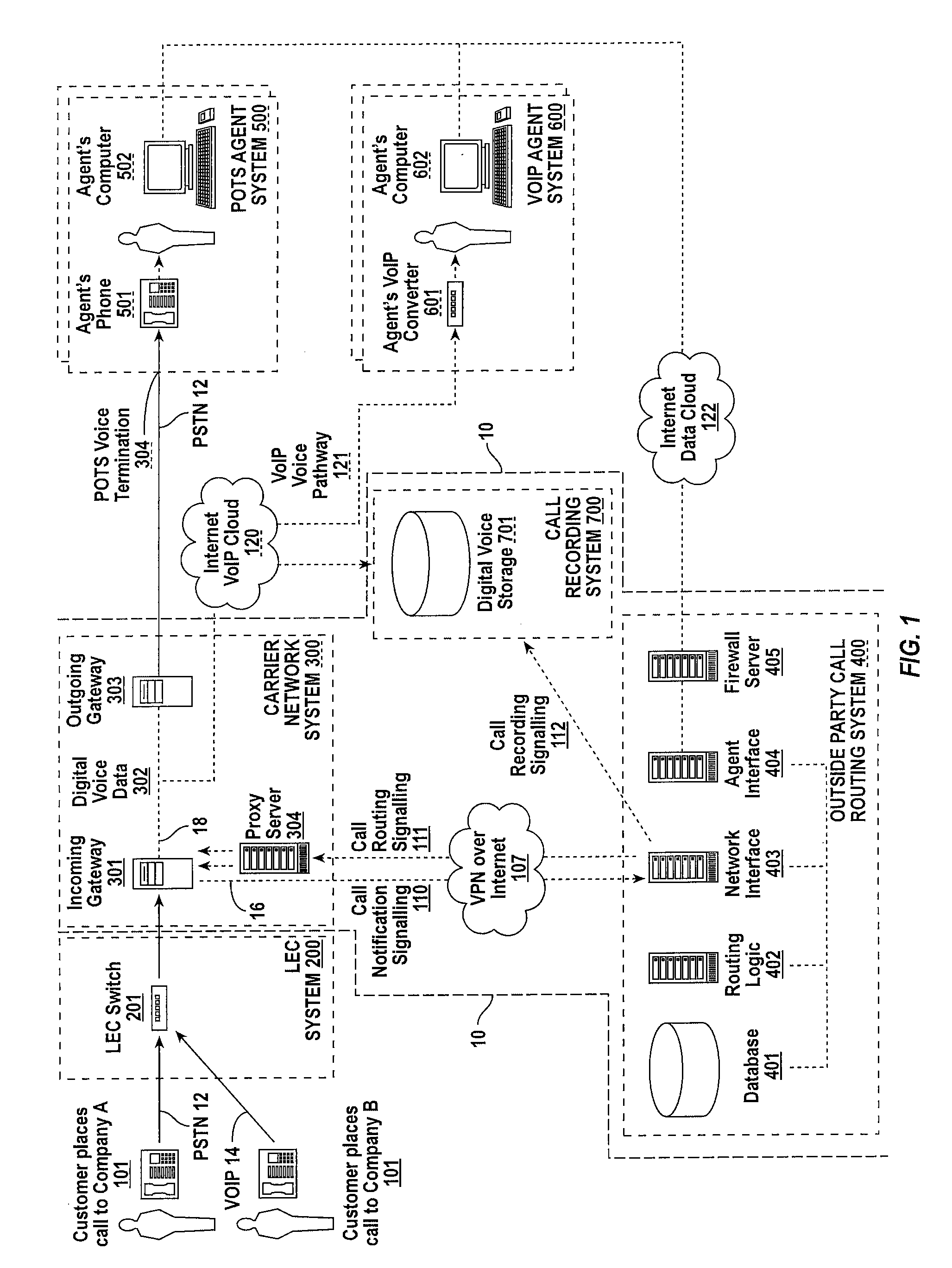

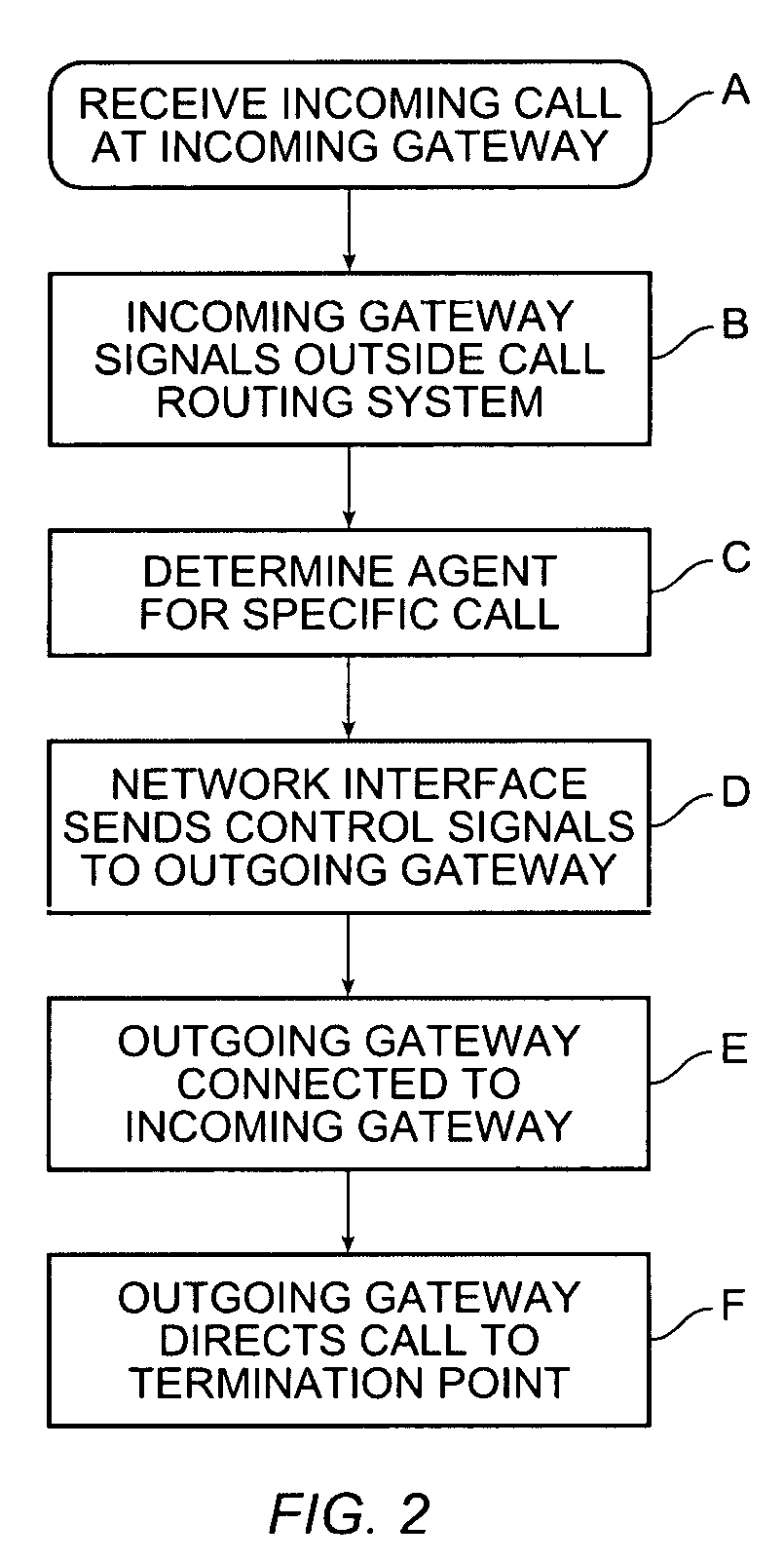

Virtual call center

ActiveUS7418092B2Minimal requirementInterconnection arrangementsSpecial service for subscribersRouting decisionCarrier signal

A system and methods are provided for enabling real-time call control. with minimal requirements for dedicated telecommunications PBX and dedicated switching equipment. Dynamic call routing is handled by a network carrier's equipment and an interface is provided at the carrier switch to dynamically redirect calls from outside of the carrier's network. A call's signaling channel and bearer (voice) channel are separated, allowing the voice carriage to continue to be handled by the network carrier, but the routing of the call is controlled from outside of the carrier's network. A real-time signaling path and interface is provided into the carrier network such that the associated routing decisions and business logic can remain outside of the carrier network, while the carrier network continues to carry the voice channels.

Owner:ALTO VENTURES INC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com