Patents

Literature

406 results about "Standard system" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

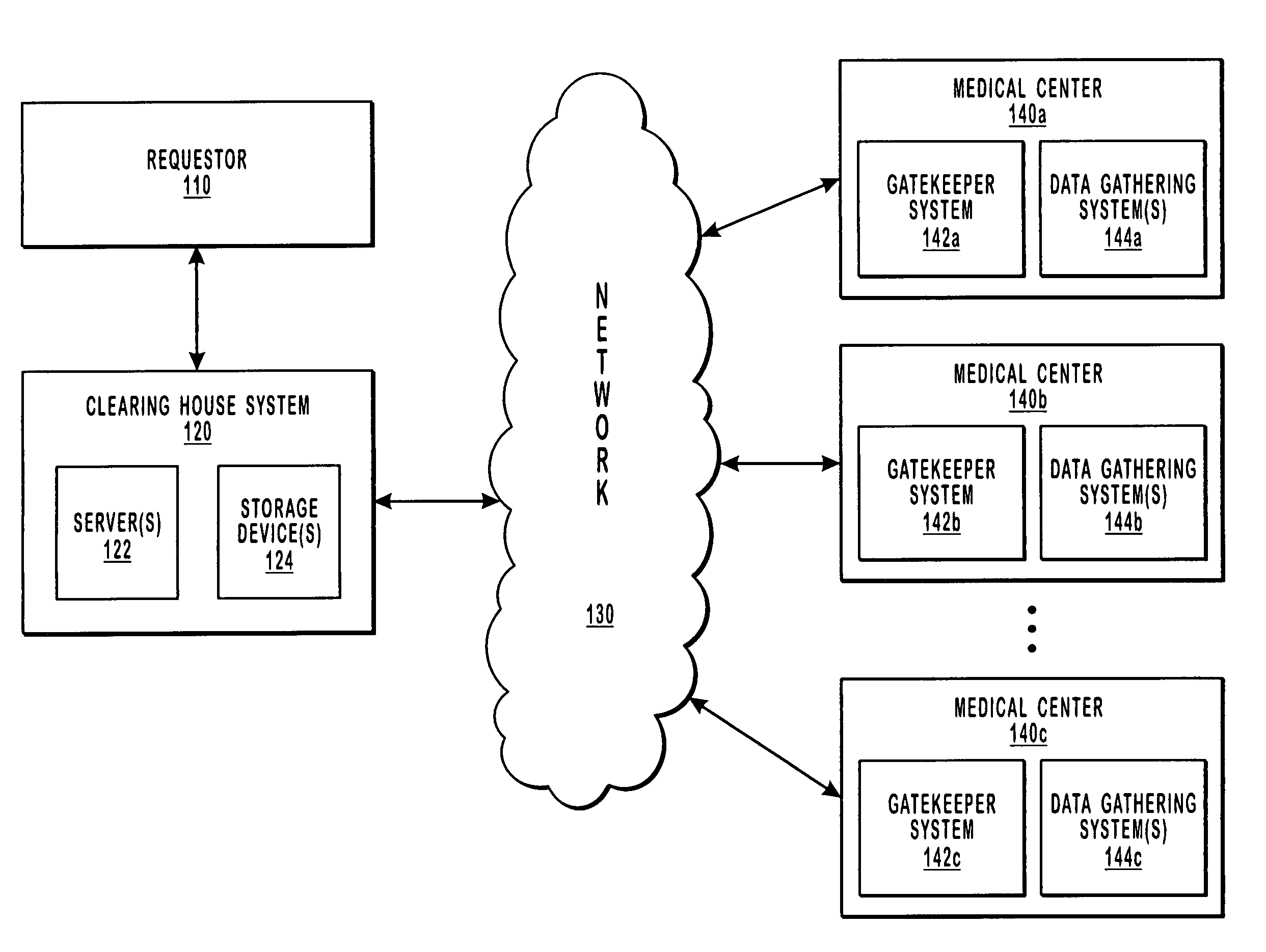

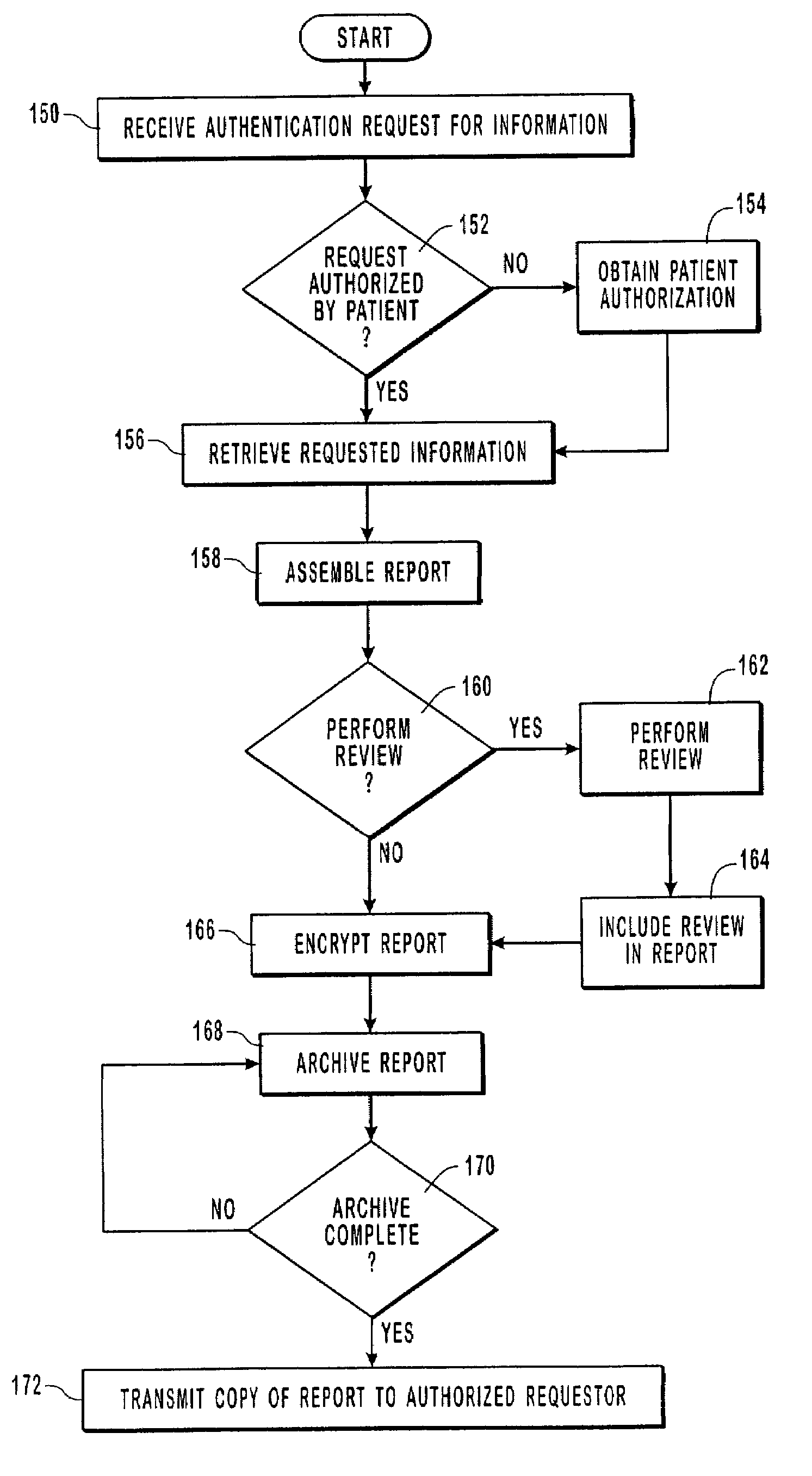

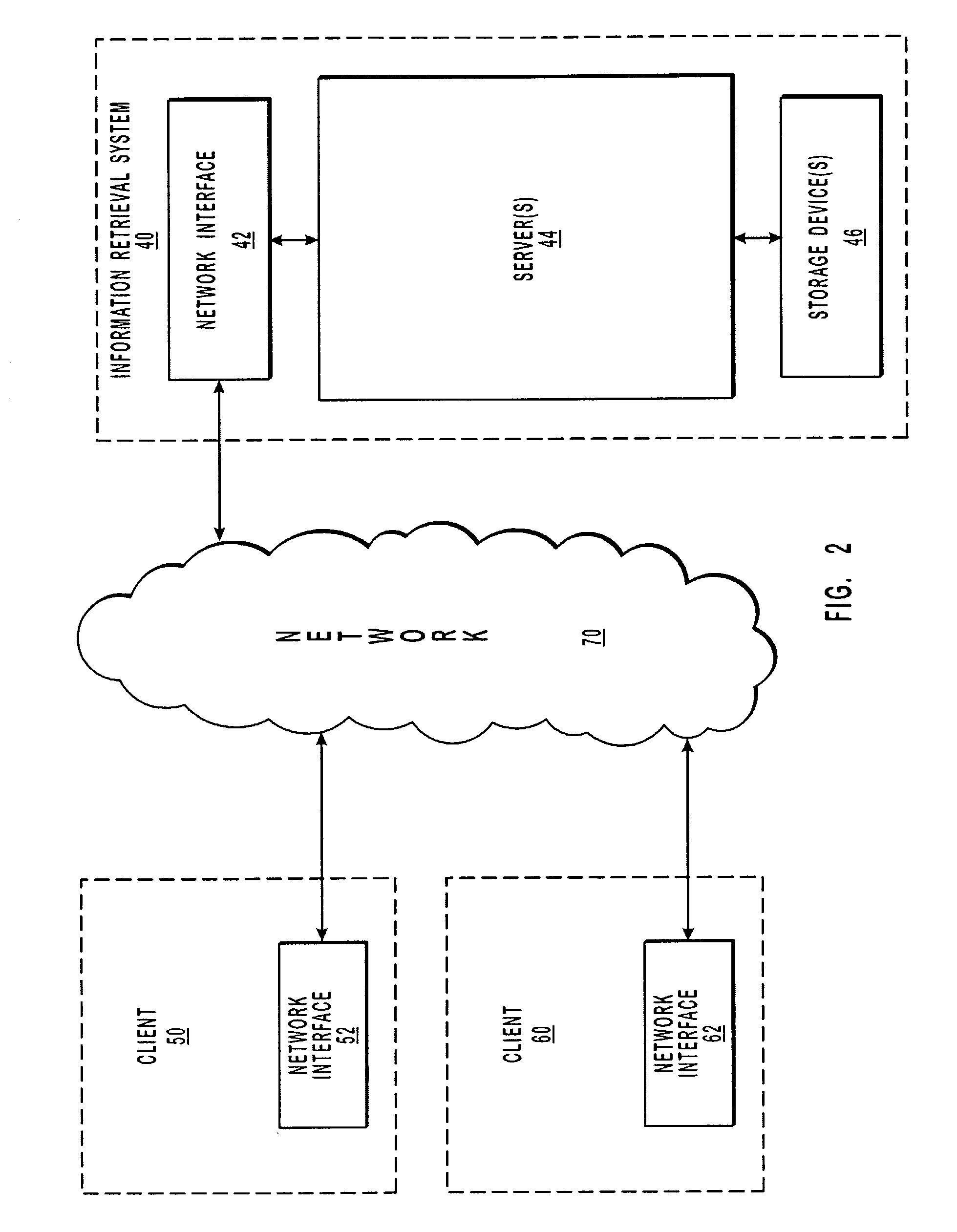

Dynamically and customizably managing data in compliance with privacy and security standards

InactiveUS9049314B2Preserving professional confidencesAvoid identificationDigital data protectionOffice automationDocumentation procedureRecordset

Owner:VERISMA SYST

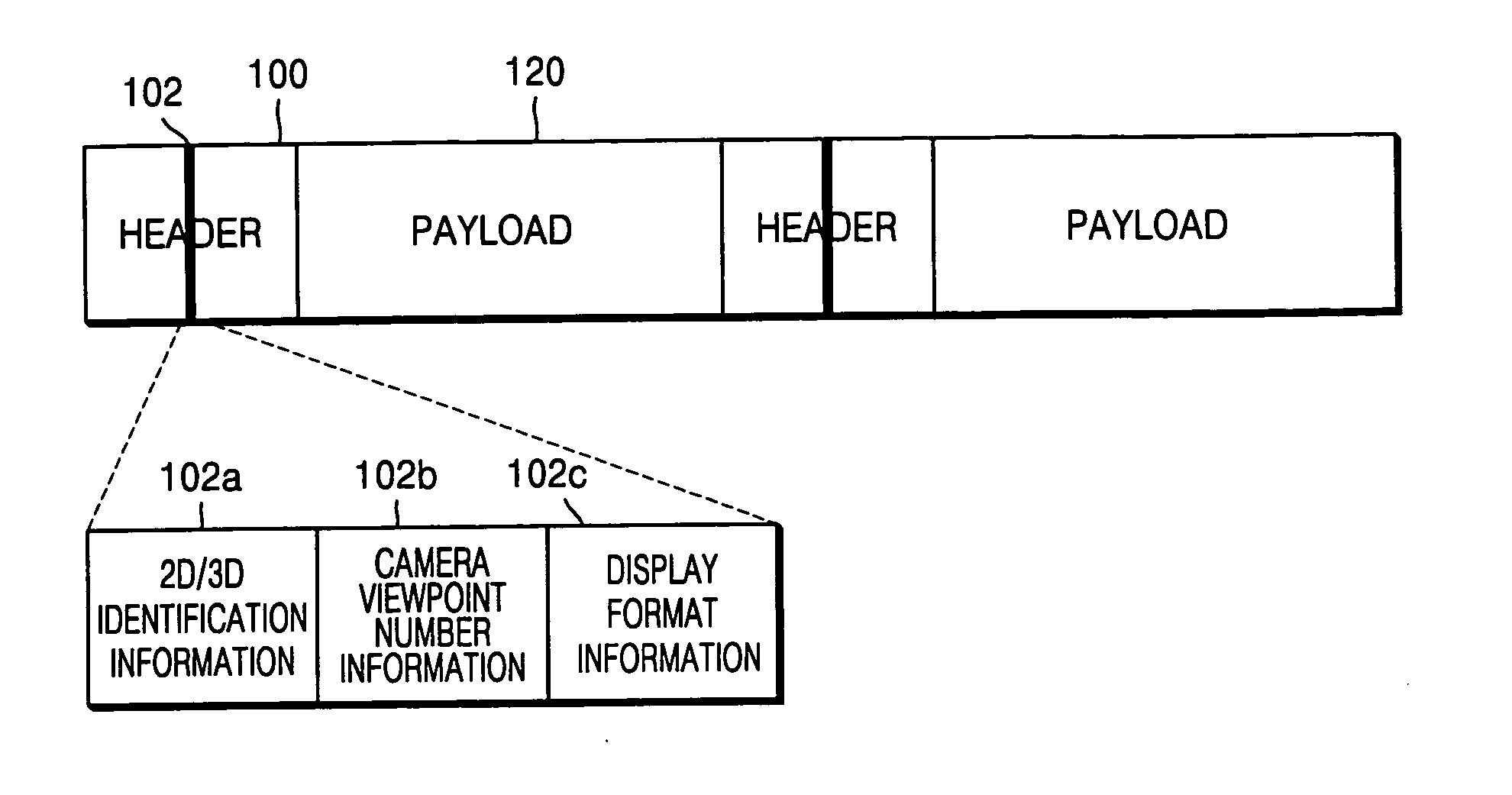

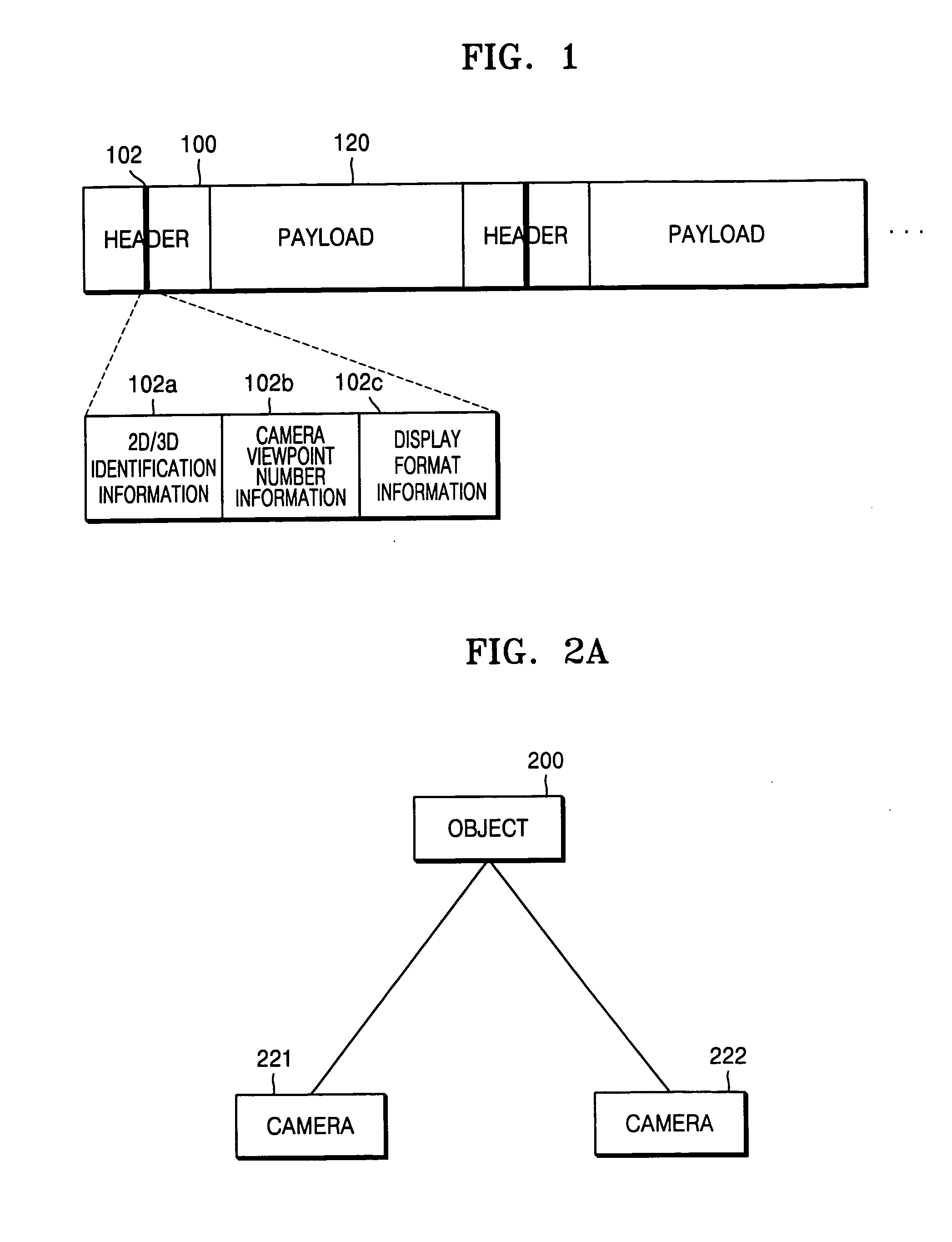

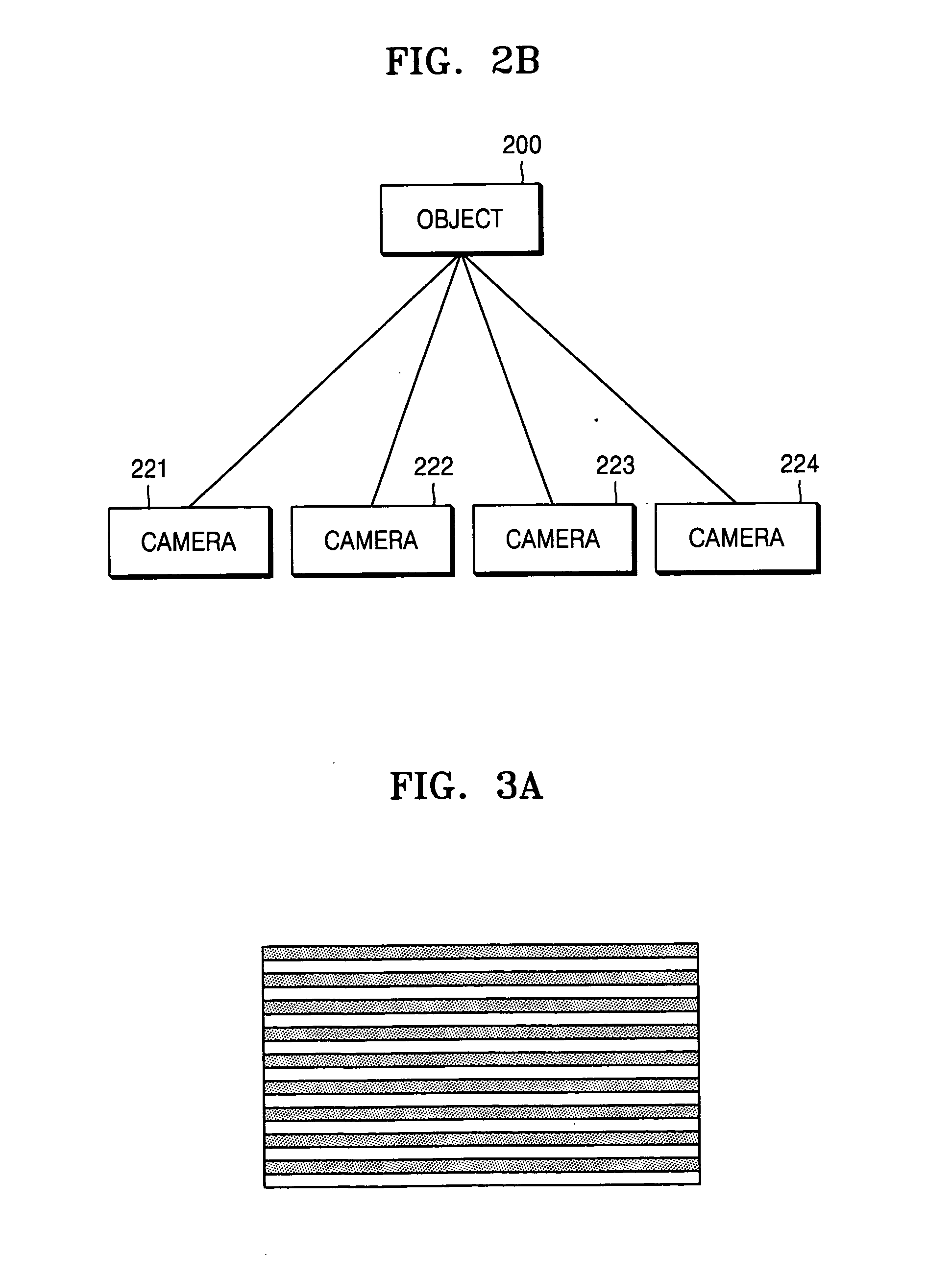

Transport stream structure including image data and apparatus and method for transmitting and receiving image data

InactiveUS20070008575A1Digital video signal modificationSelective content distribution3d imageDigital broadcasting

An image transmitting apparatus and method and an image receiving apparatus and method, the image receiving apparatus including a decoder receiving and decoding an image signal including image data and an image characteristic parameter which contains information indicating whether the image data represents a two-dimensional (2D) image or a three-dimensional (3D) image, an image characteristic parameter detector receiving the decoded image signal and extracting and interpreting the image characteristic parameter from the decoded image signal, and a display unit receiving the image characteristic parameter from the image characteristic parameter detector and displaying the image data received from the decoder according to the image characteristic parameter, to display a 2D image and a 3D image in various fields, such as a 3D image broadcast, etc., that can be shown on a digital broadcast standard system.

Owner:SAMSUNG ELECTRONICS CO LTD

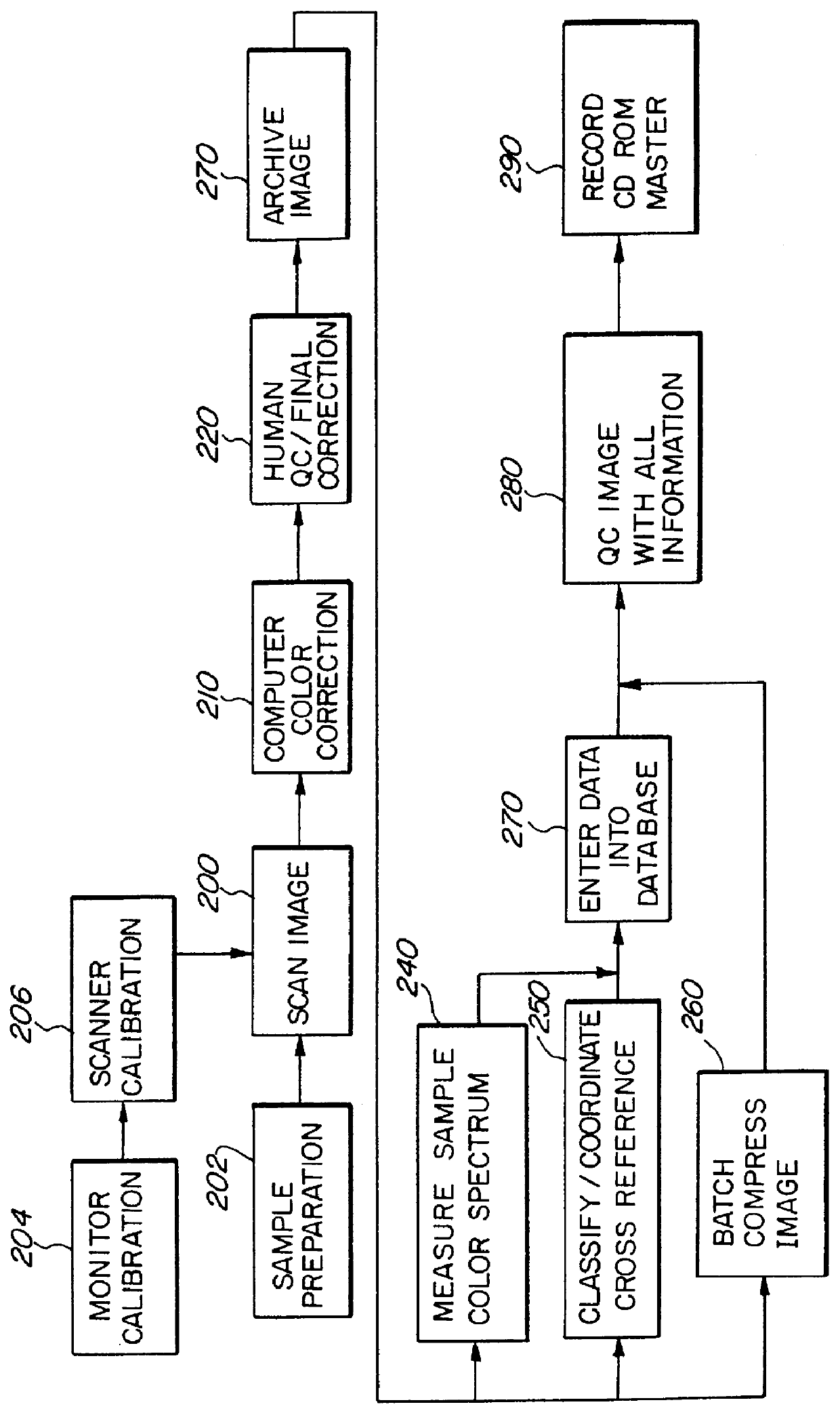

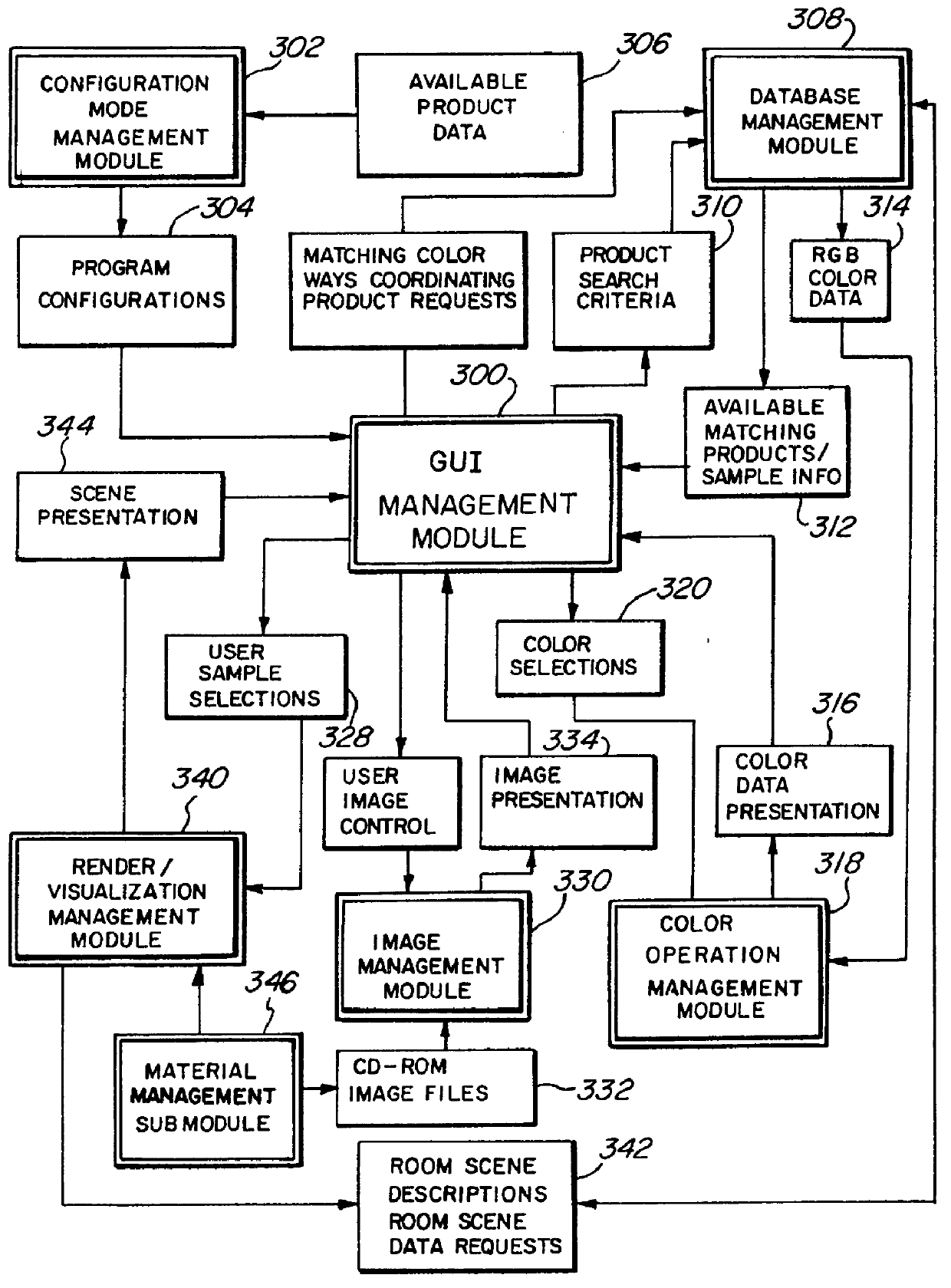

Spectrally coordinated pattern search-imaging system and method

InactiveUS6122391AChoose simpleDigital data information retrievalTexturing/coloringColor imageCD-ROM

A system for selecting decorative materials is based on large numbers of high-resolution, full color images of decorative materials stored in a compressed format on an inexpensive medium such as a CD-ROM. In creating the ROM, each image is coordinated with additional information such as style of pattern, type of material, and other auxiliary information. Before final compression and storage of the image data color information is added by spectrophotometrically analyzing the decorative material. Color values for a background color and up to four foreground colors are determined. Individual colors are then referenced to a comprehensive color standard system containing a large number of standardized color swatches. Spectrophotometric color referencing allows the data records to be rapidly searched on the basis of color, as well as the other information in the record. Wallpaper patterns, drapery material, floor covering, or paint can then be rapidly selected on the basis of matching color. Various patterns and paints can be compared side by side on a high-resolution computer monitor that has been calibrated to produce an accurate color image. Finally, the chosen paints and other decorating materials can be rendered onto a room image so that the consumer can view an accurate simulation of the chosen materials.

Owner:AUTODESK INC

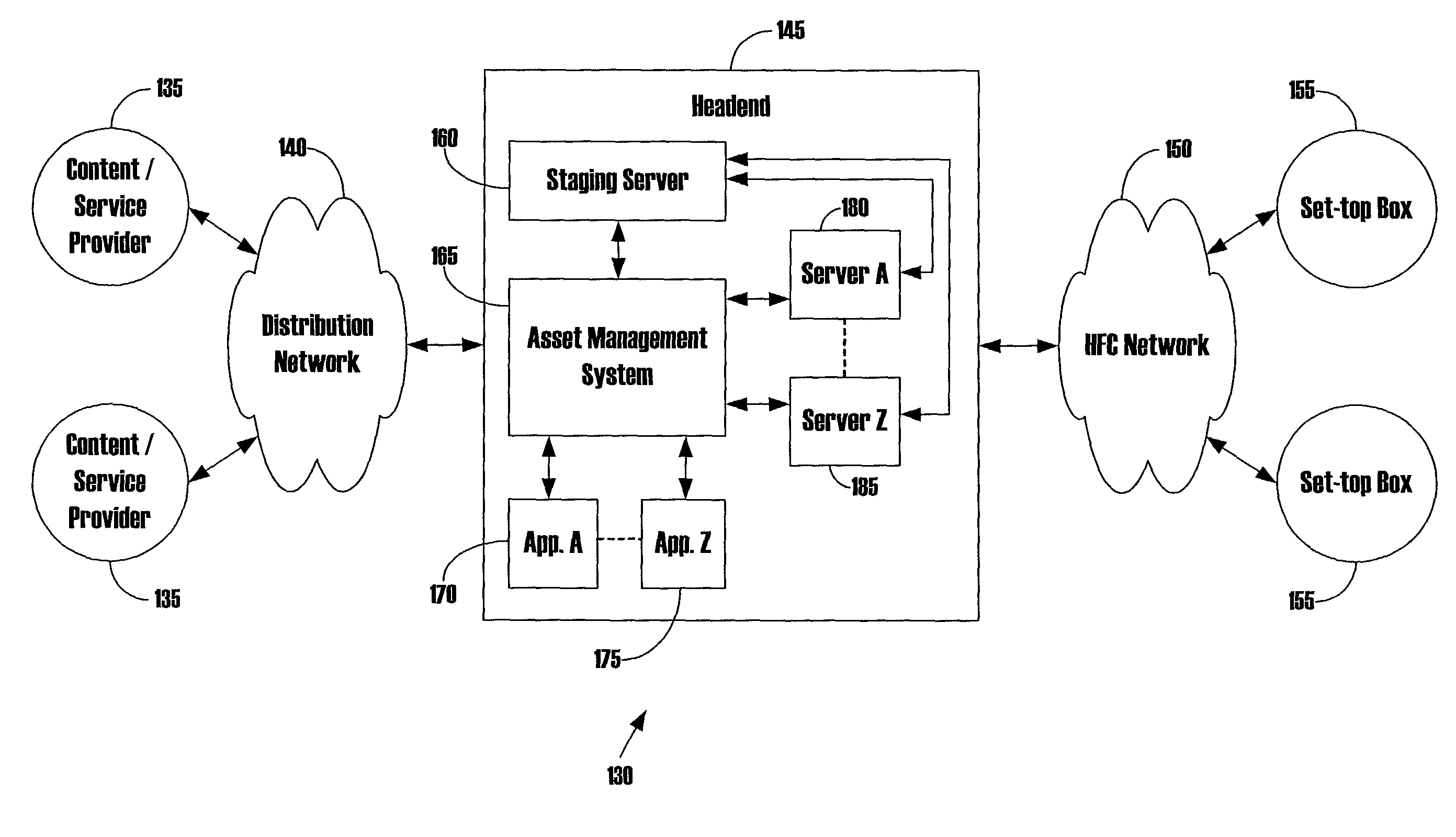

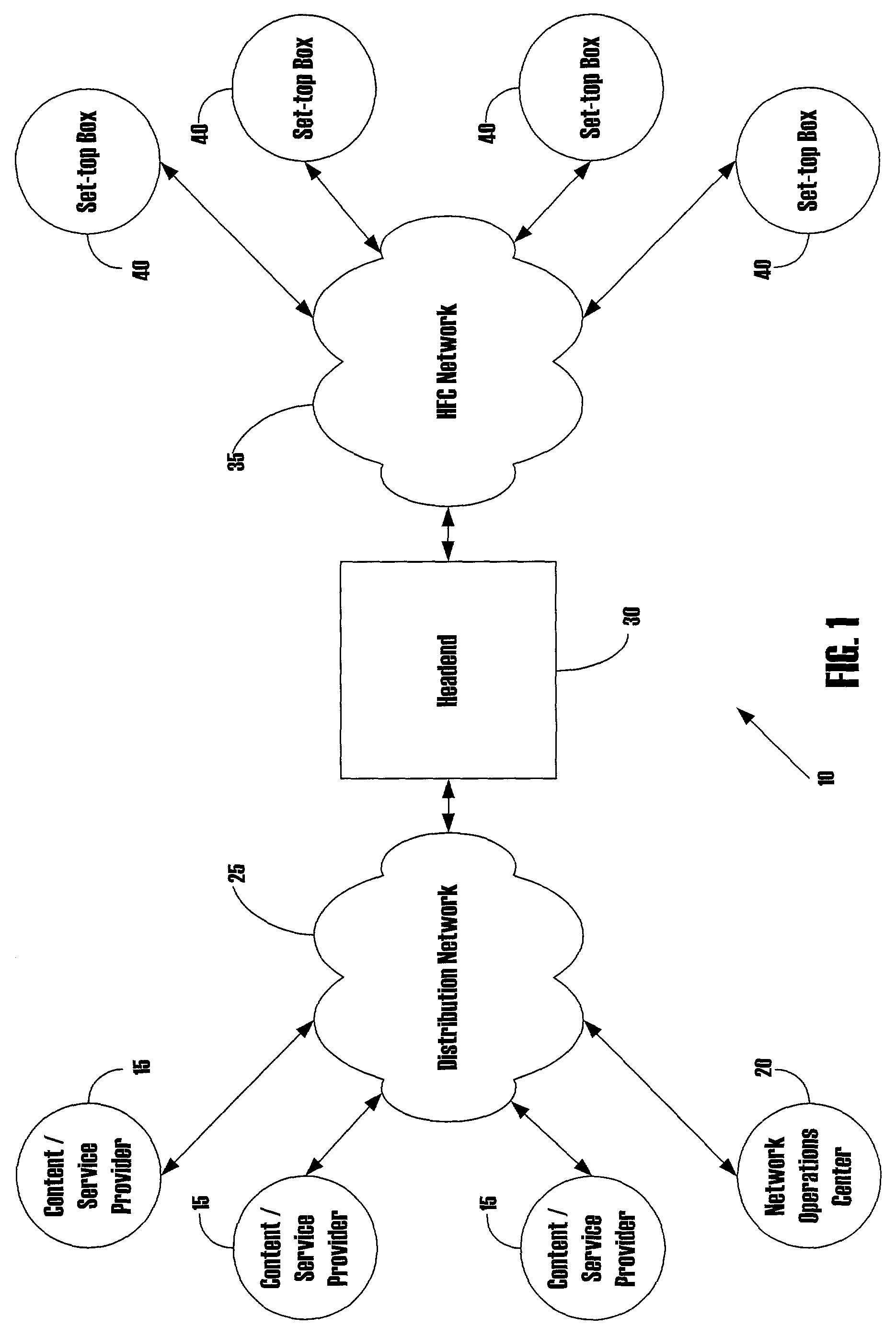

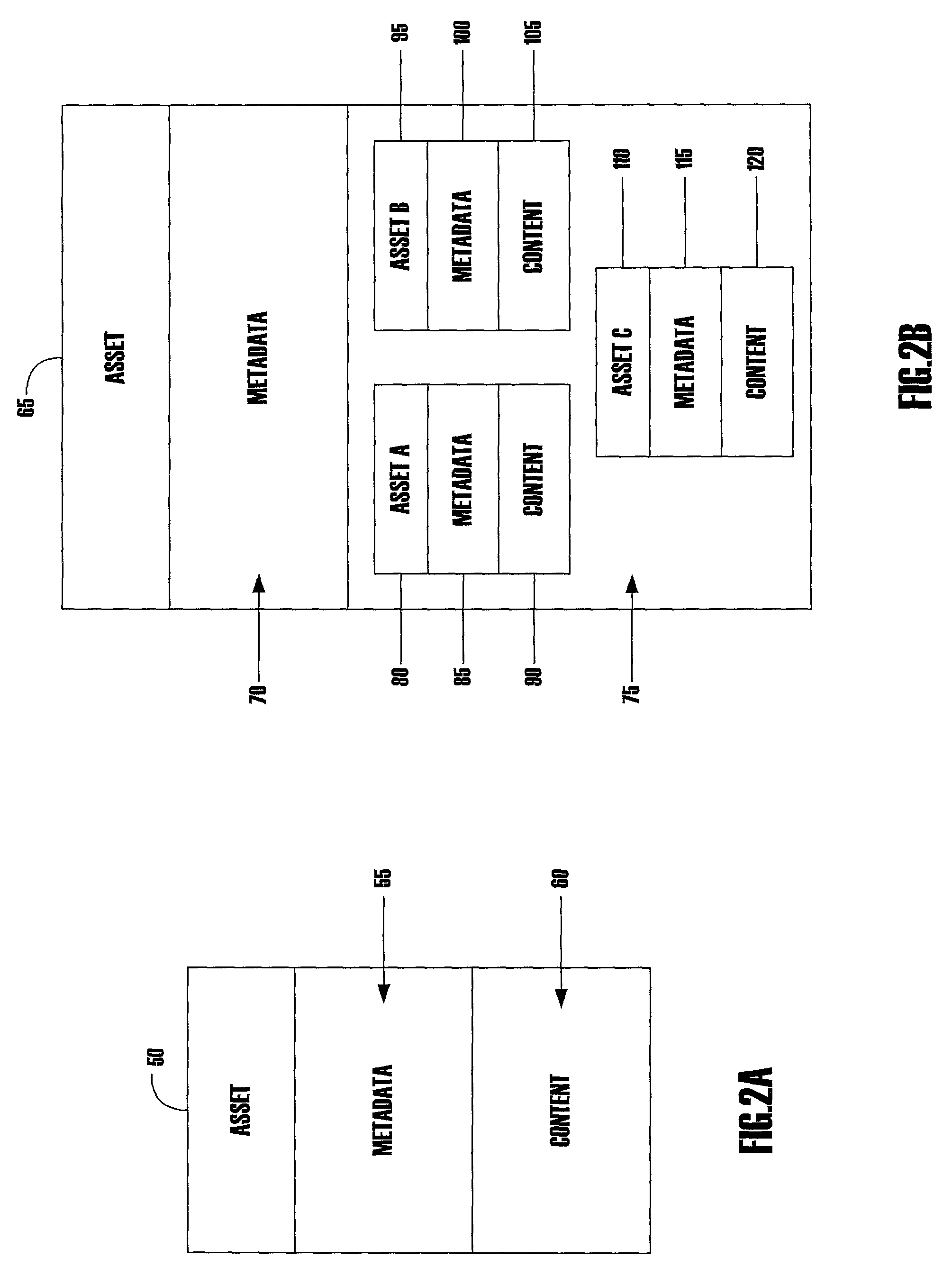

Systems and methods for packaging, distributing and managing assets in digital cable systems

ActiveUS7761899B2Digital computer detailsAnalogue secracy/subscription systemsTelevision systemService provision

Assets, such as content and related data are packaged, transmitted, received and managed in a digital cable television system to standardize the distribution of content and services from a content / service provider to subscribers in the system. The standardized format for packaging content enables the digital cable system to package, transmit, receive and manage diverse types of content, such as MPEGs, executable files, HTML pages, and the like, using standard system components without requiring reprogramming of the system to deploy new services. Service and content providers are freed from having to develop custom formats for delivering content and data to the cable system. Moreover, the standardized bundling of content and related data that is enabled by the invention allows the cable system operator to automate the deployment of services based on specific content and data to select subscribers.

Owner:N2 BROADBAND +1

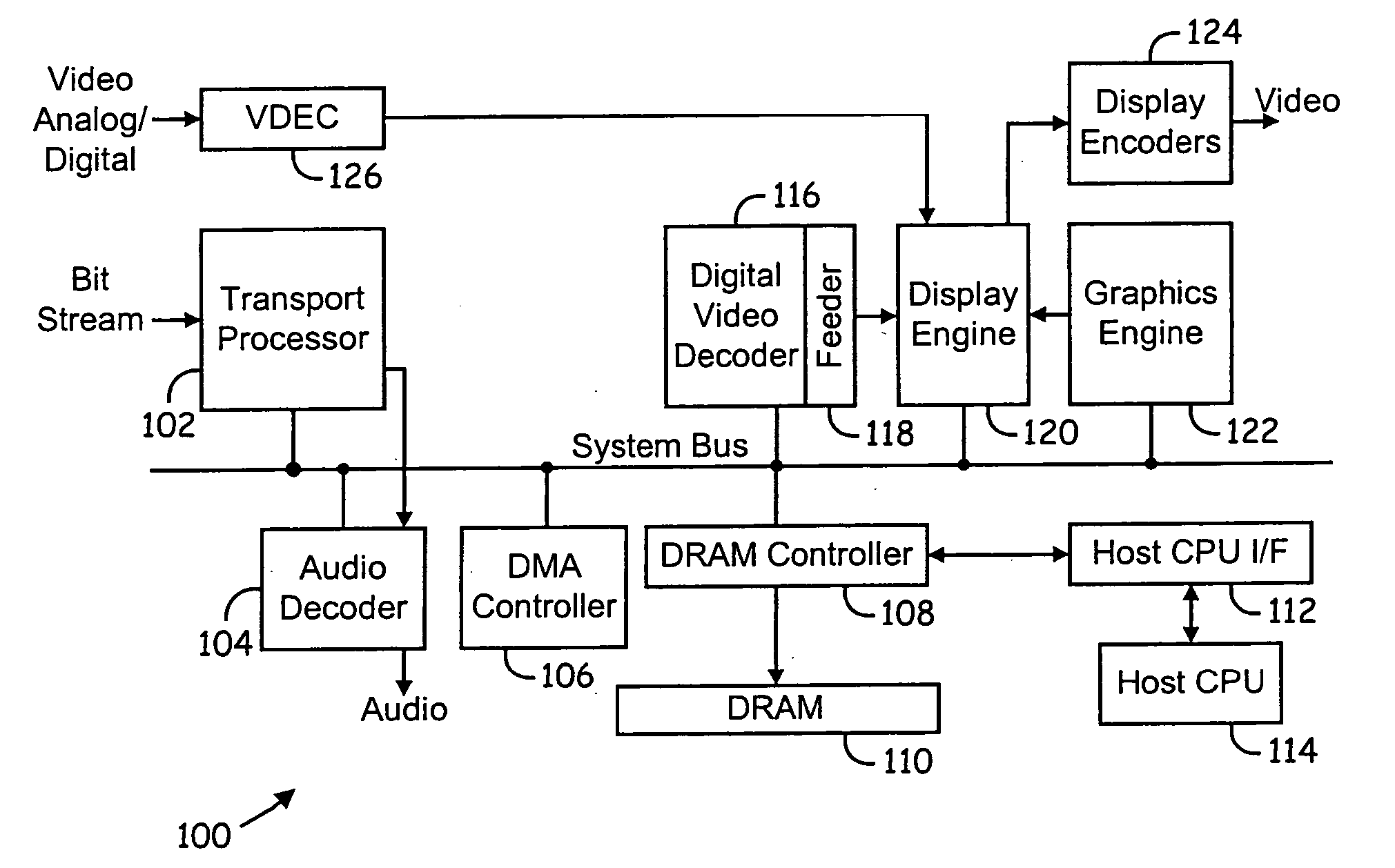

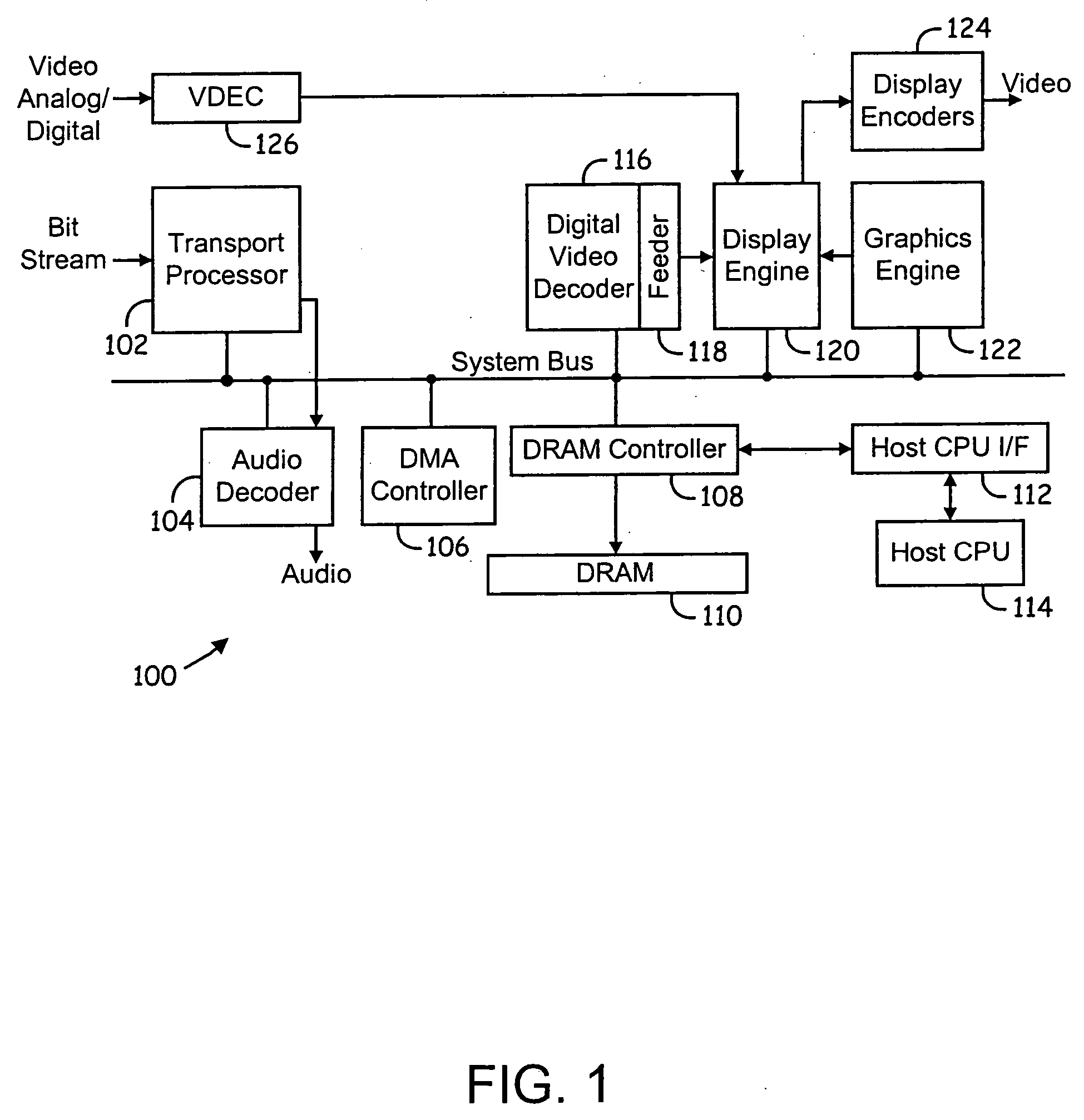

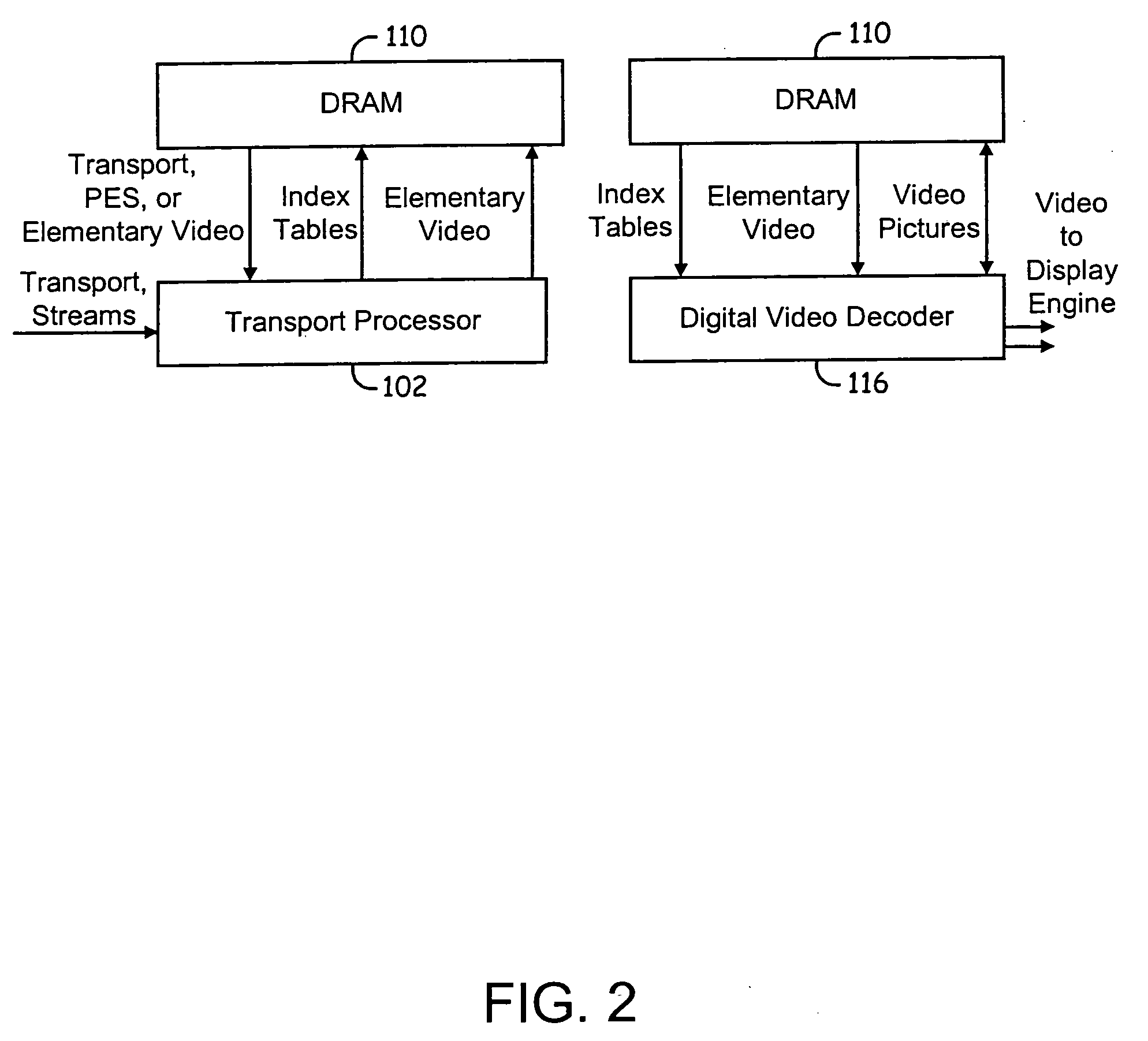

Video decoding system supporting multiple standards

ActiveUS20050123057A1Picture reproducers using cathode ray tubesPicture reproducers with optical-mechanical scanningDigital videoData stream

System and method for decoding digital video data. The decoding system employs hardware accelerators that assist a core processor in performing selected decoding tasks. The hardware accelerators are configurable to support a plurality of existing and future encoding / decoding formats. The accelerators are configurable to support substantially any existing or future encoding / decoding formats that fall into the general class of DCT-based, entropy decoded, block-motion-compensated compression algorithms. The hardware accelerators illustratively comprise a programmable entropy decoder, an inverse quantization module, a inverse discrete cosine transform module, a pixel filter, a motion compensation module and a de-blocking filter. The hardware accelerators function in a decoding pipeline wherein at any given stage in the pipeline, while a given function is being performed on a given macroblock, the next macroblock in the data stream is being worked on by the previous function in the pipeline.

Owner:BROADCOM CORP

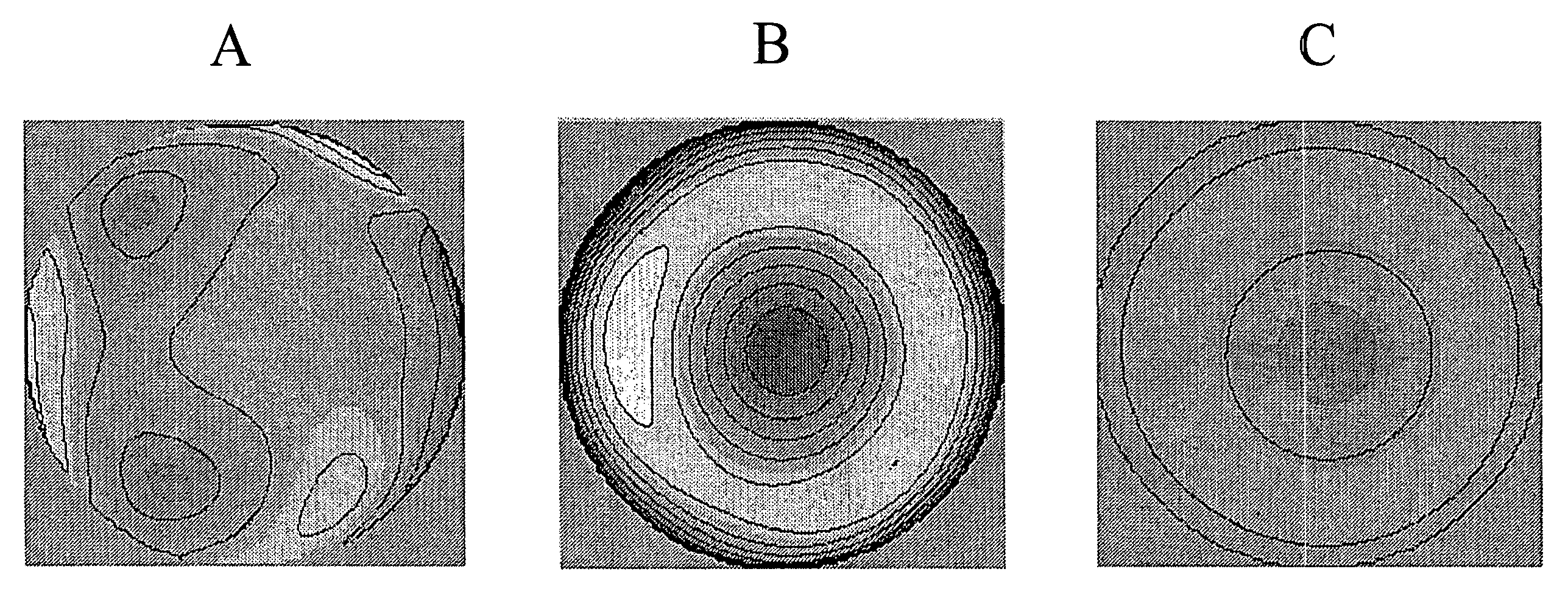

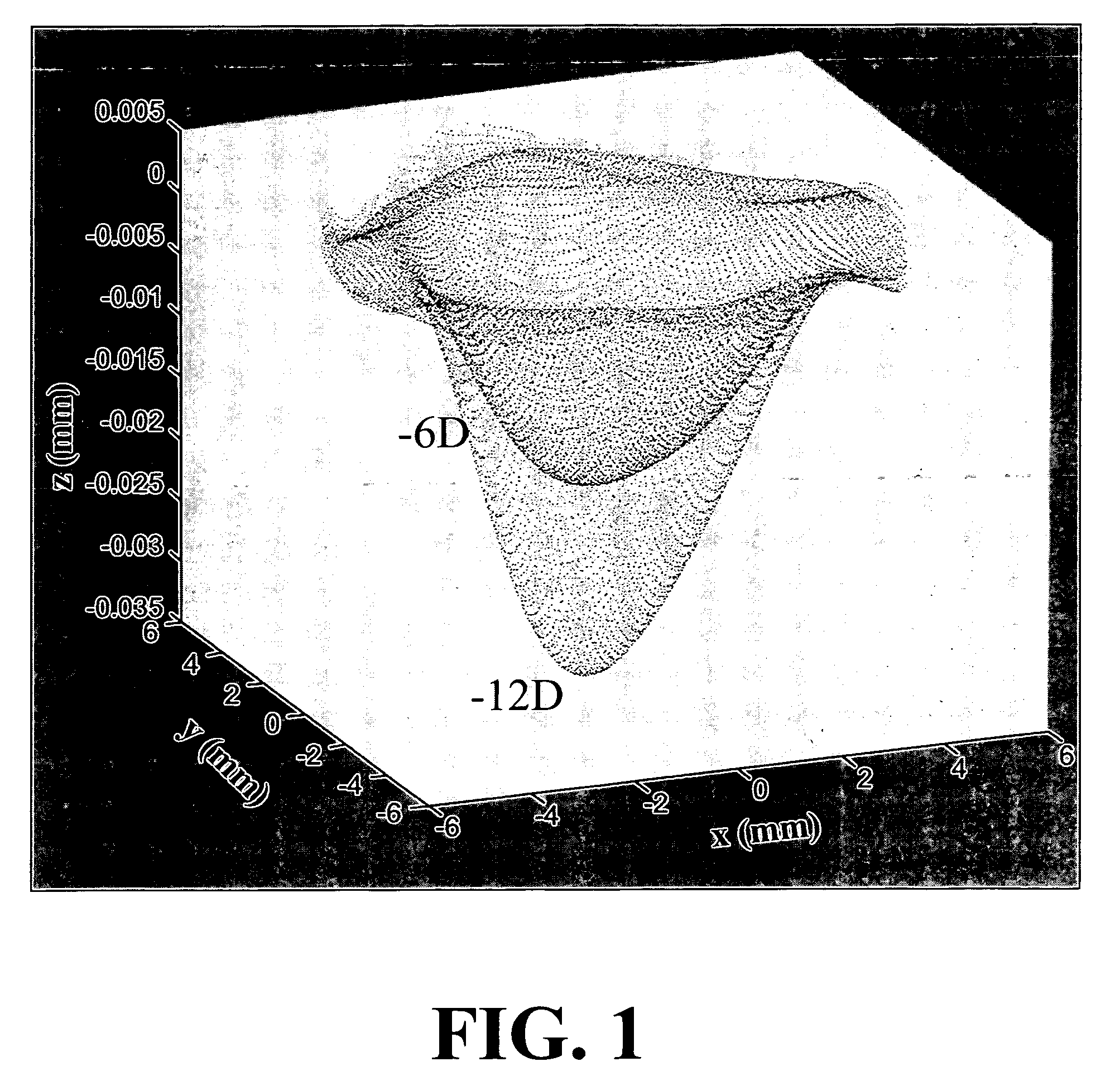

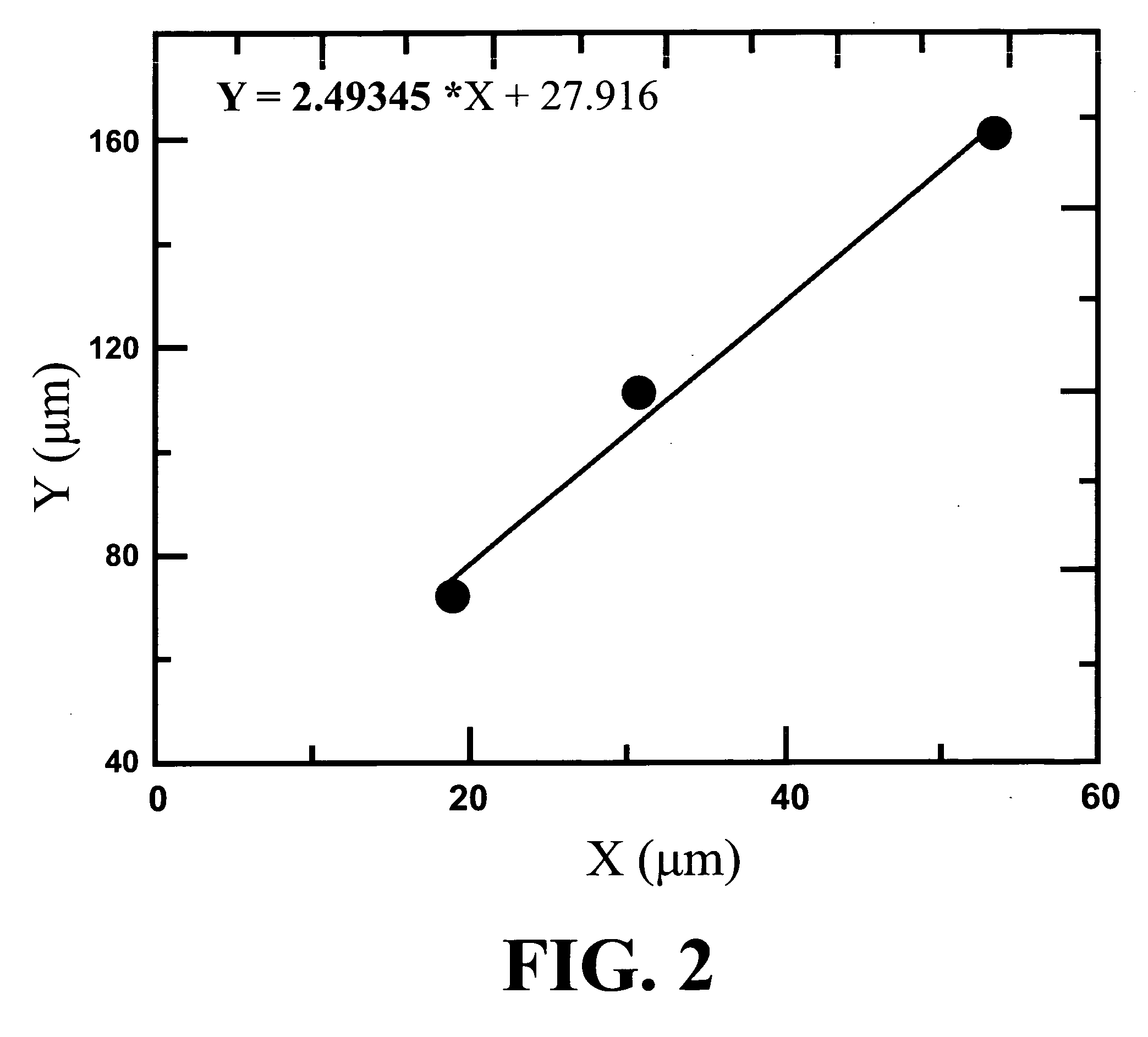

Method of preventing the induction of aberrations in laser refractive surgery systems

InactiveUS20070038202A1Simple technologyImprove optical qualityLaser surgerySurgical instrument detailsNear sightednessVisual perception

The invention relates to a method of preventing the induction of aberrations in laser refractive surgery systems. Standard laser refractive surgery systems successfully correct low-order refractive errors (myopia, hypermetropia and astigmatism), but induce spherical aberration and, by extension, other high-order aberrations, which result in a worsening of vision quality. Said increase in spherical aberration is due to the shape of the cornea, and not inherent in the theoretical ablation profile, and, as a result, the problem is, in principle, common to all laser systems. The invention relates to a systematic method which can be used with any system and ablation profile in order to obtain a profile correction factor. The correction factor, which is specific to each system, can be applied in order to prevent the induction of spherical aberration and, in this way, improve the optical and visual quality of patients following surgery compared to surgery performed with standard systems. Moreover, the inventive method can be used to improve the production of lenses with controlled high-order aberrations using laser systems.

Owner:CONSEJO SUPERIOR DE INVESTIGACIONES CIENTIFICAS (CSIC)

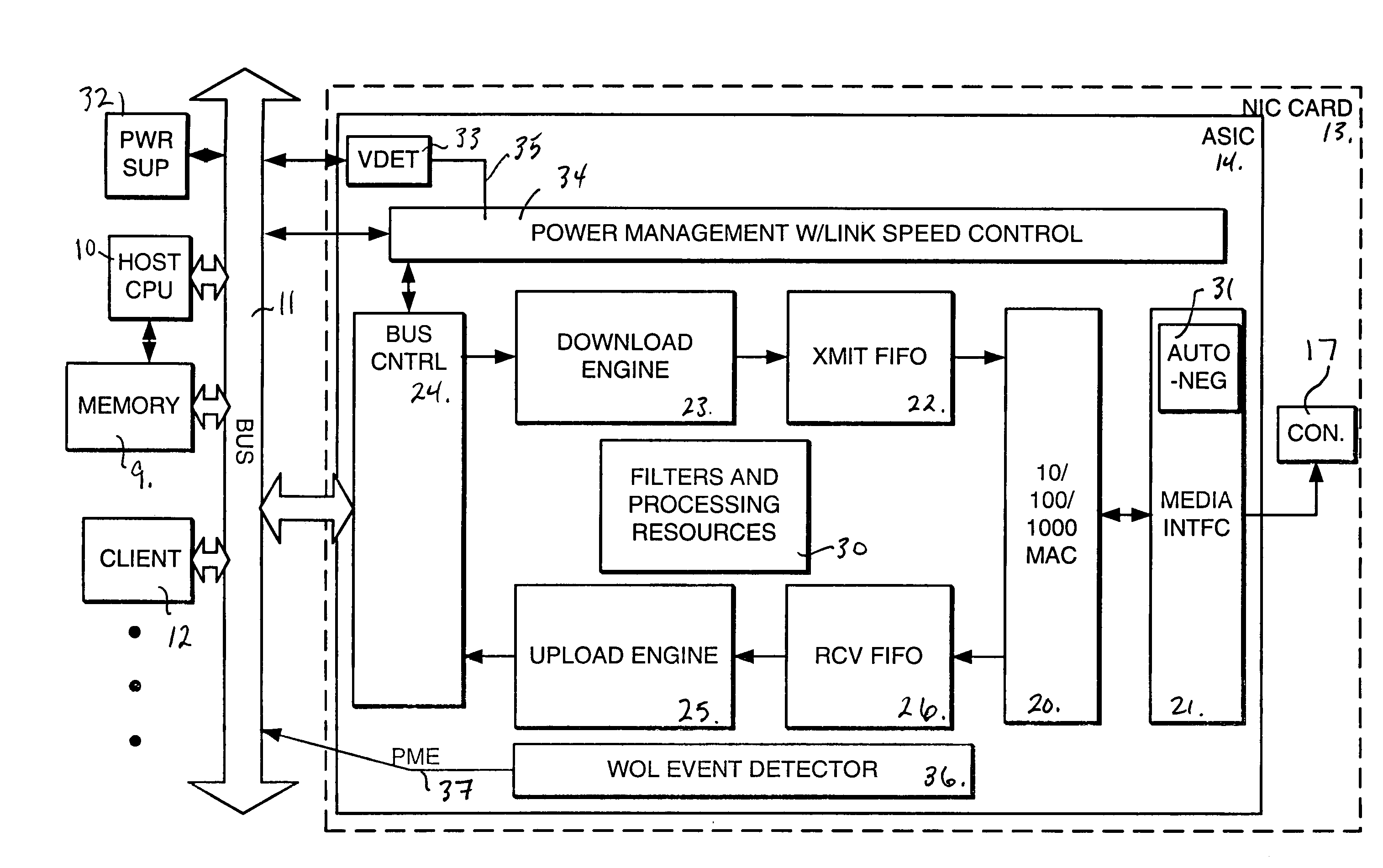

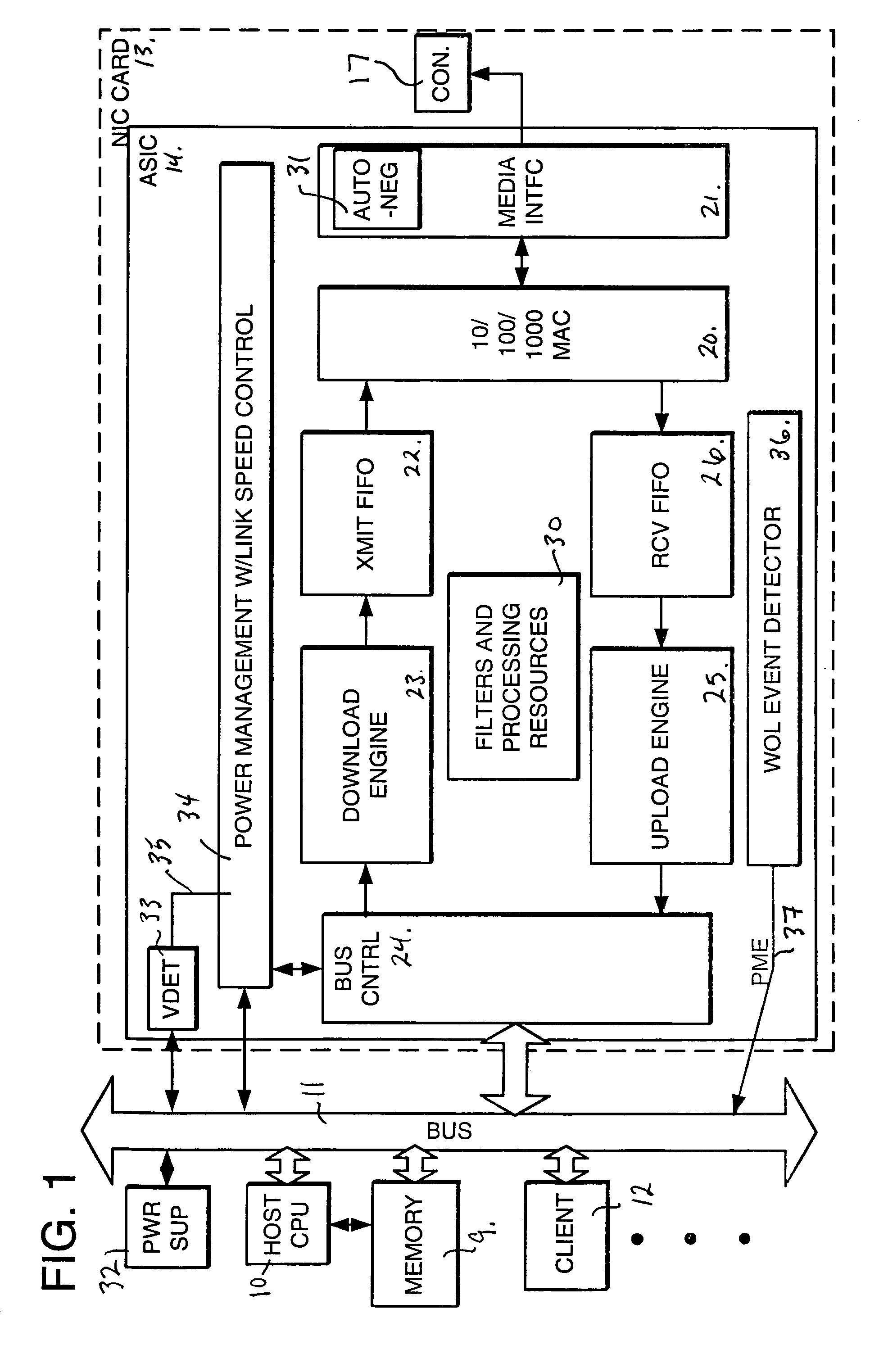

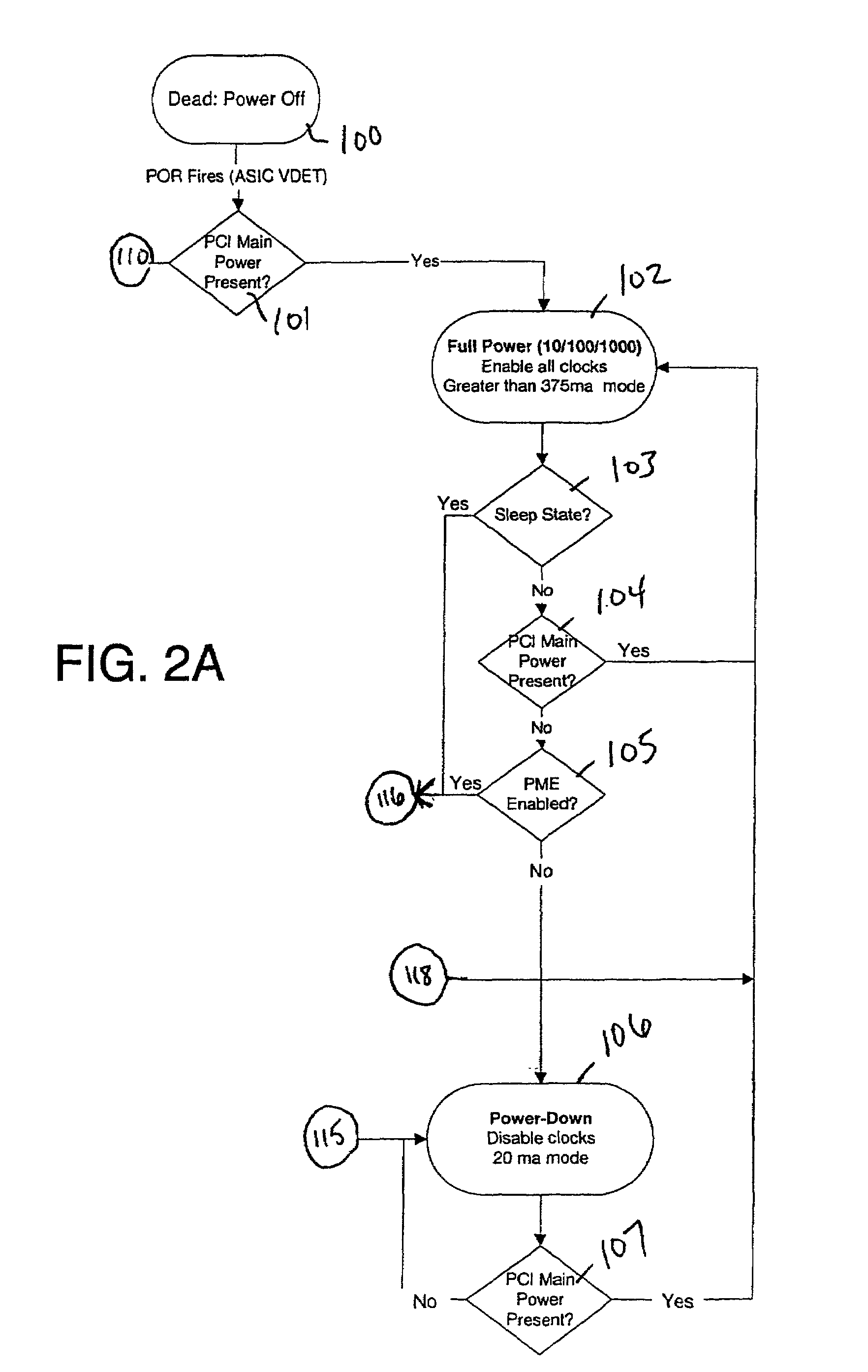

High speed network interface with automatic power management with auto-negotiation

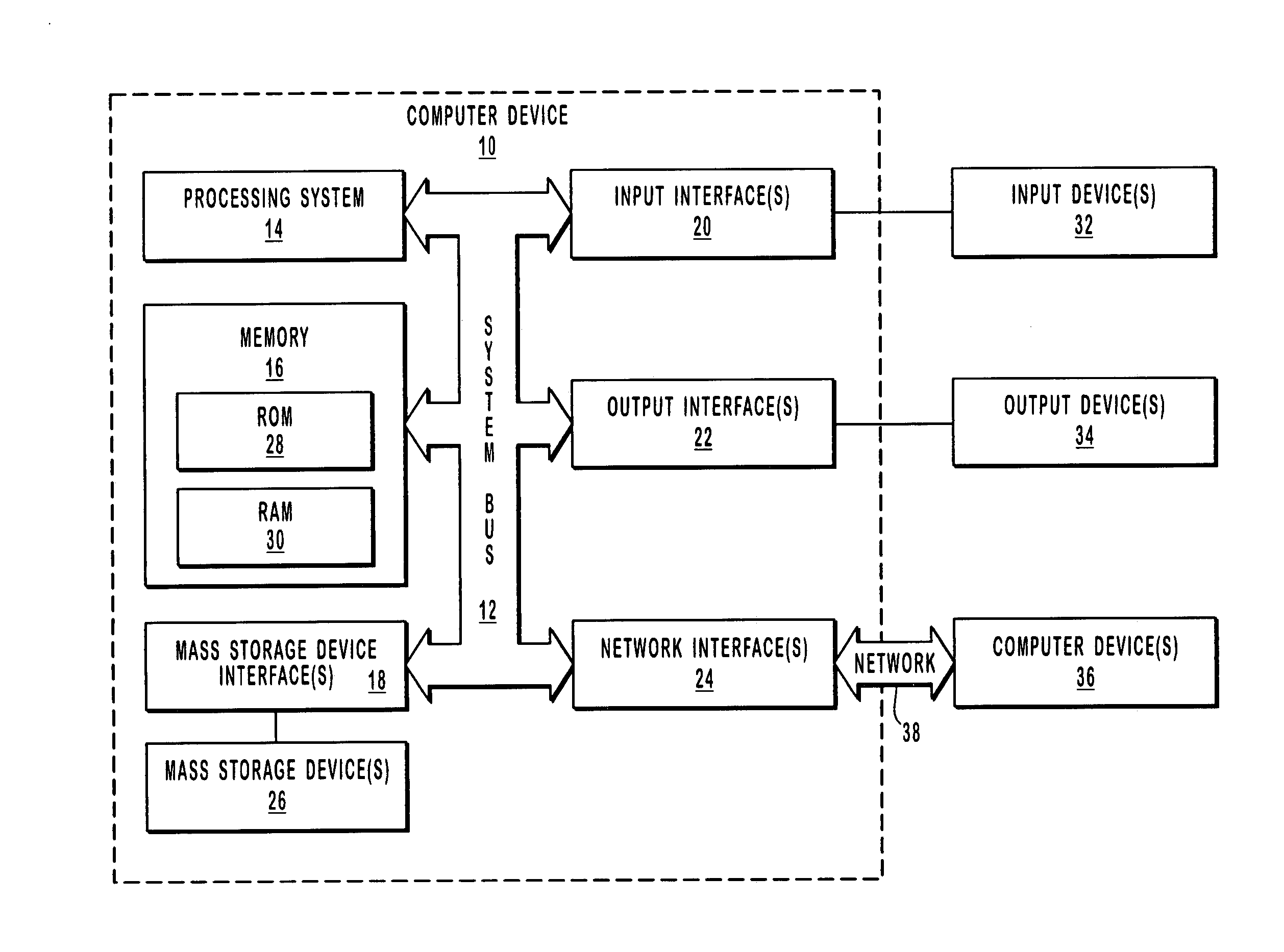

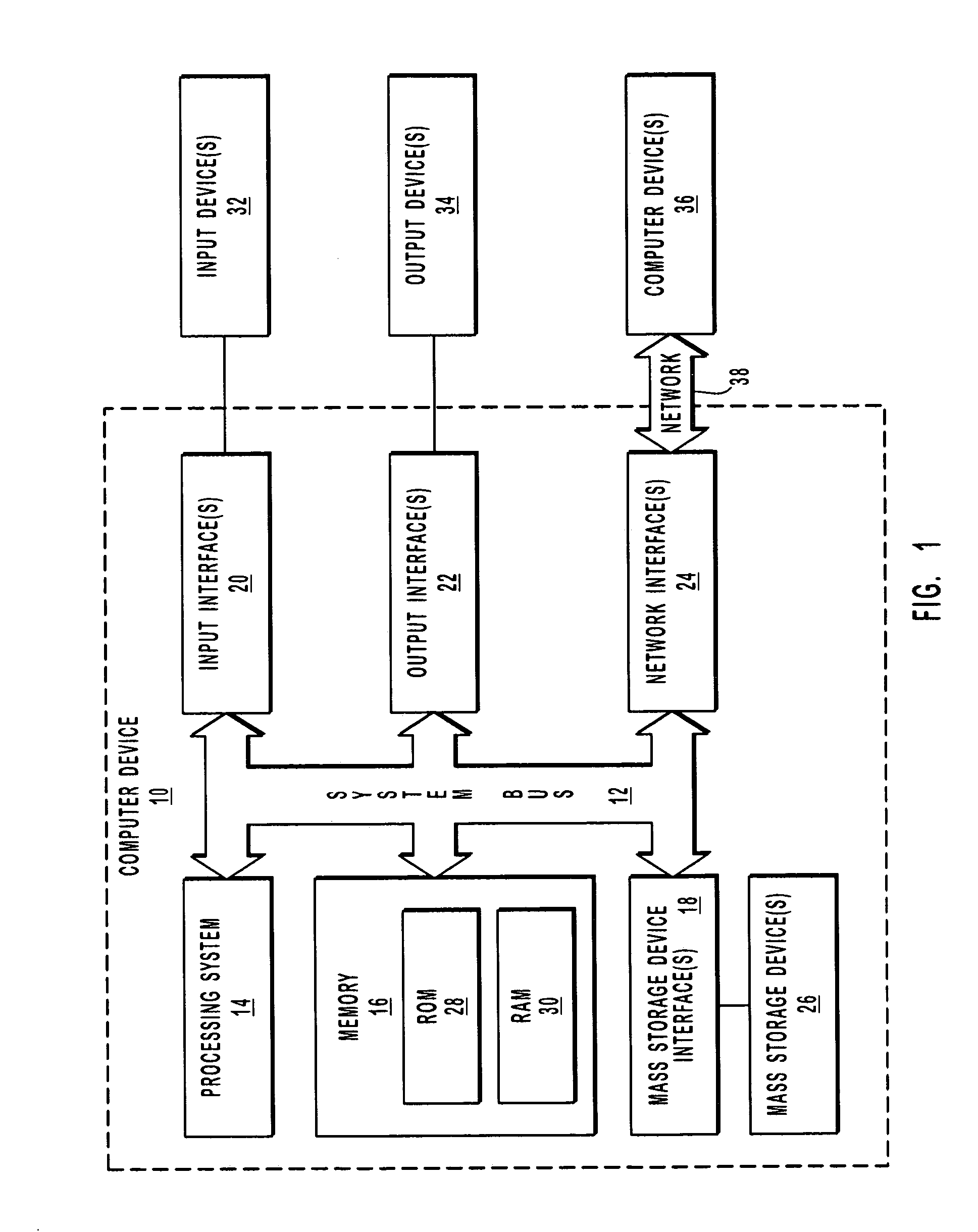

ActiveUS7577857B1Avoid physical damageEnergy efficient ICTVolume/mass flow measurementLow speedNetwork media

A computer system comprises host processor and a network interface, wherein the host processor includes resources supporting a full power mode, a lower power mode and a power down mode, as seen in standard system bus specifications such as PCI and InfiniBand. The network interface includes a medium interface unit coupled to network media supporting a least high speed protocol, such as a Gigabit Ethernet or high-speed InfiniBand, and a lower speed protocol, such as one of 10 Mb and 100 Mb Ethernet or a lower speed InfiniBand. Power management circuitry forces the medium interface unit to the lower speed protocol in response to an event signaling entry of the lower power mode. In the lower power mode, the network interface consumes less than the specified power when executing the lower speed protocol, and consumes greater than the specified power when executing the high speed protocol. Logic in the network interface operates in the lower power mode, and uses the lower speed protocol to detect a pattern in incoming packets. In response to the detection of said pattern, the logic issues a reset signal to the host processor. Thus, the network interface operates as a wake-up device in the lower power mode, using the lower speed protocol.

Owner:HEWLETT-PACKARD ENTERPRISE DEV LP +1

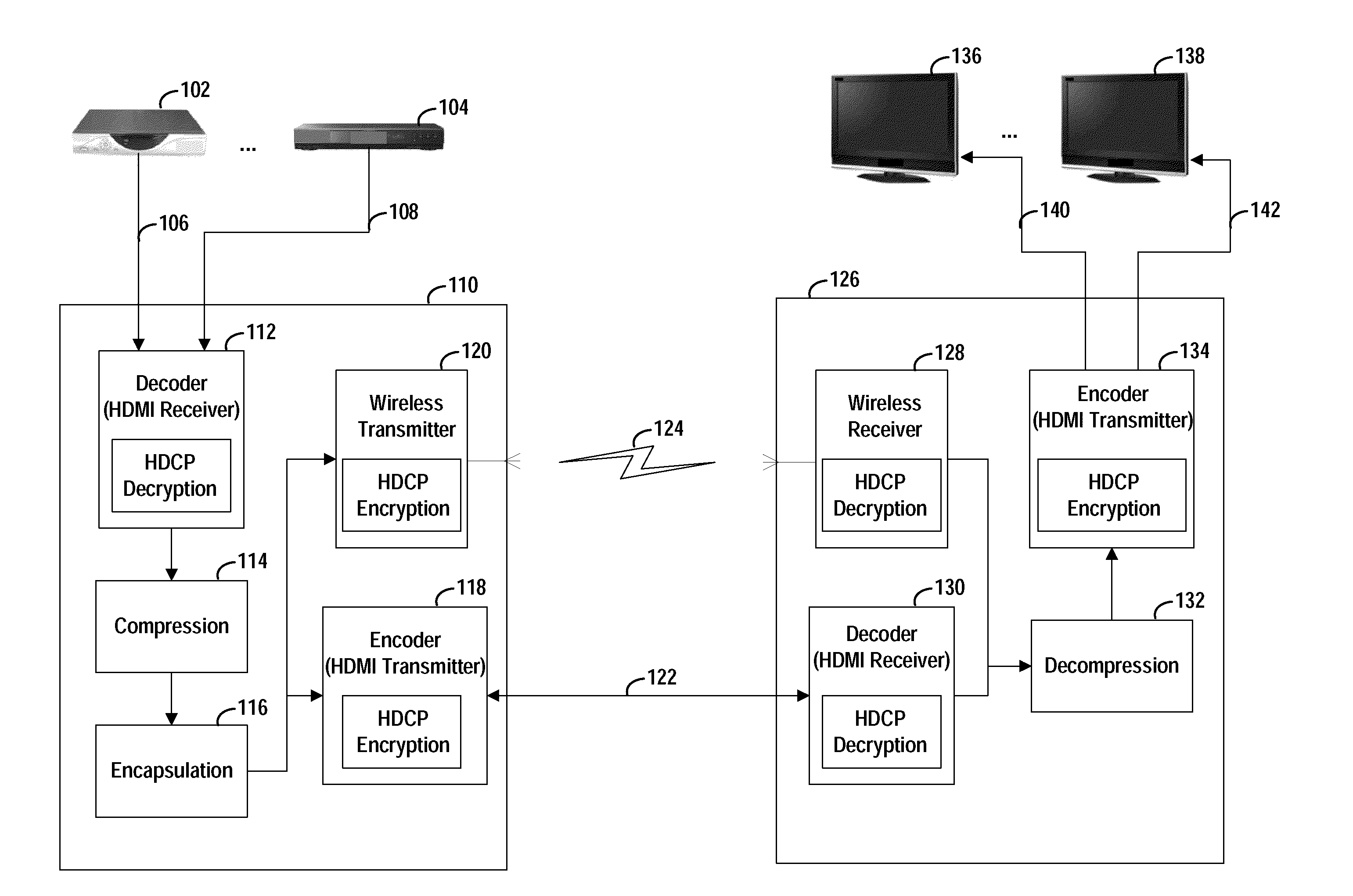

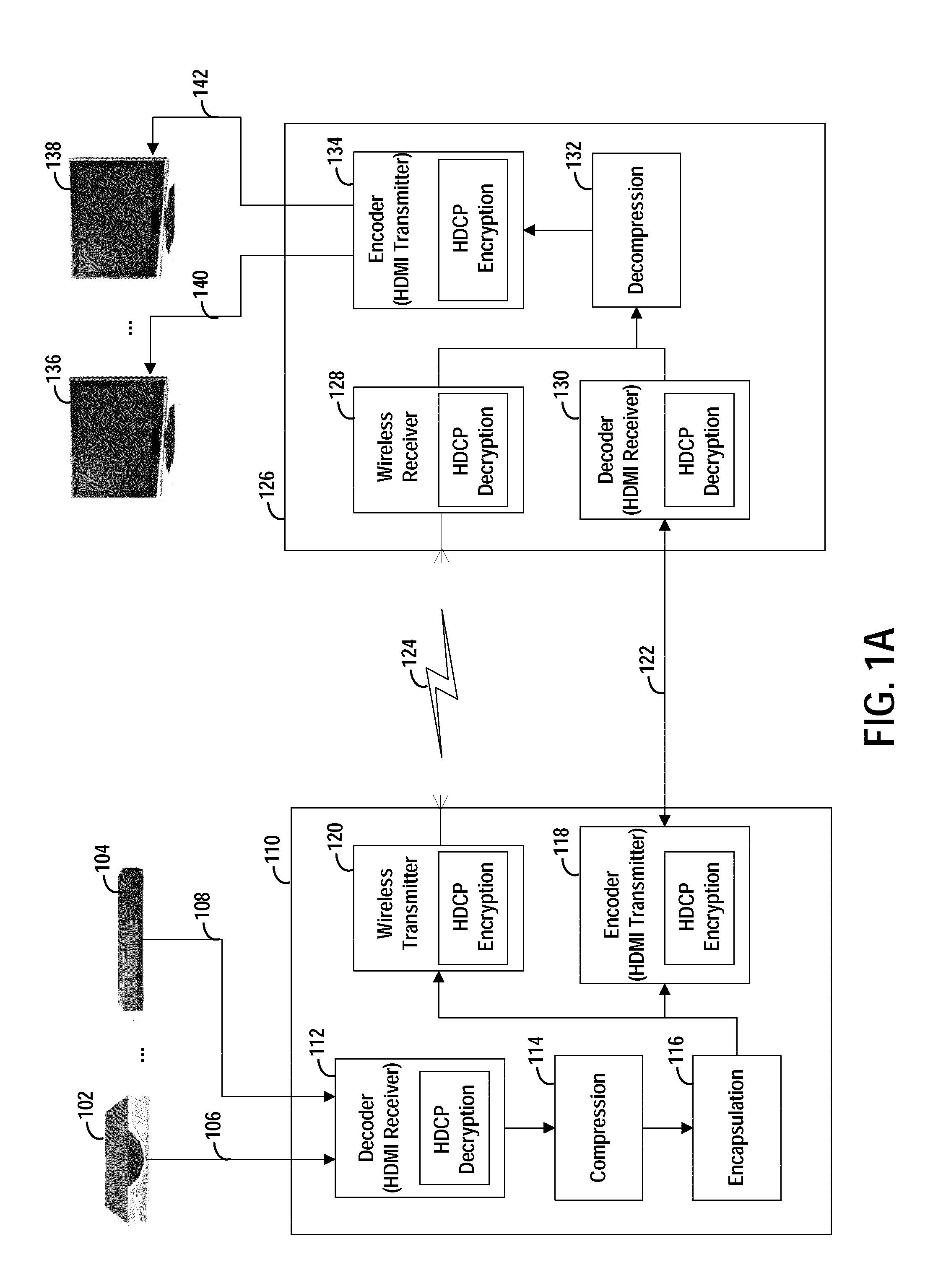

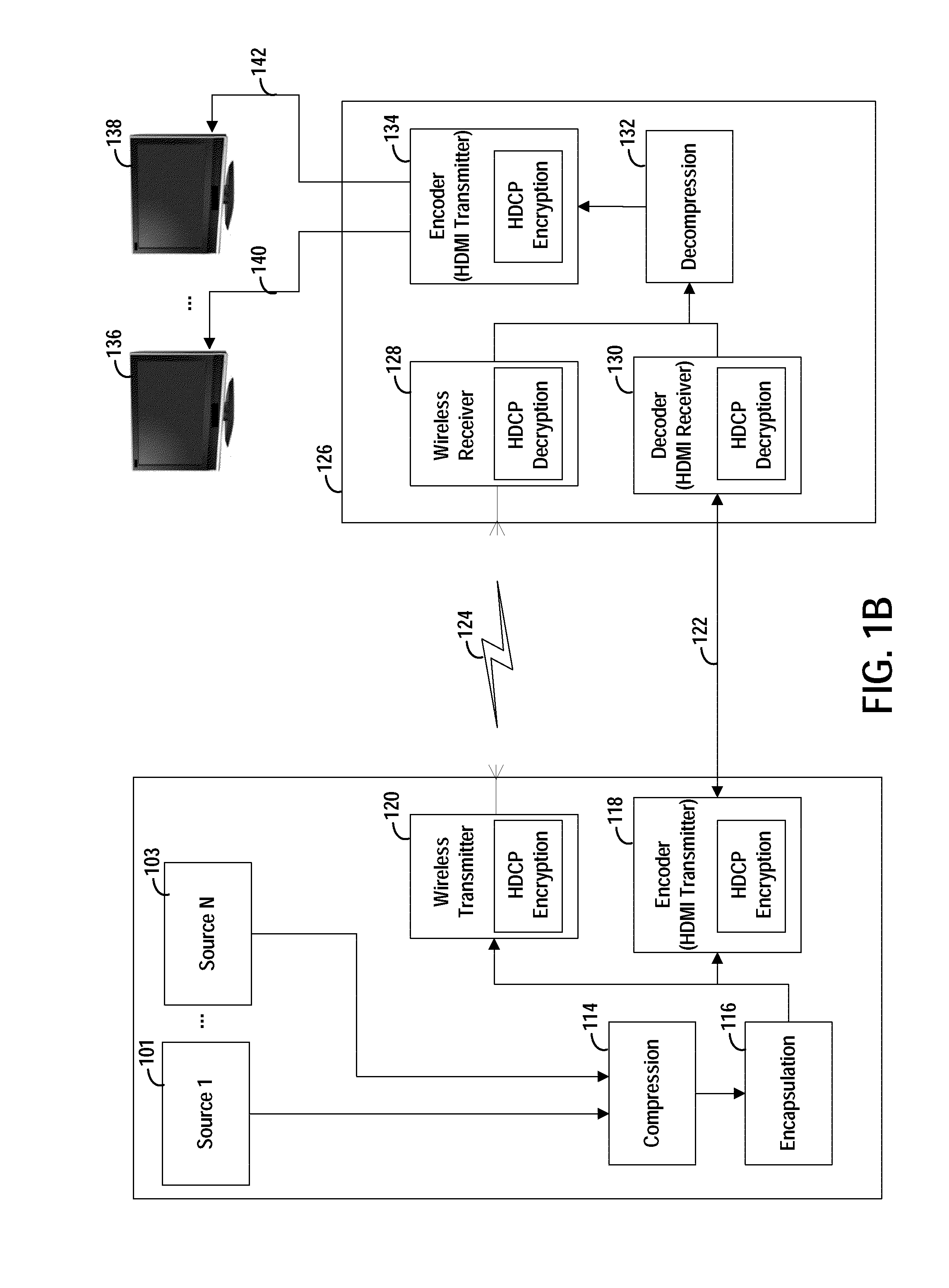

Methods, systems and devices for compression of data and transmission thereof using video transmission standards

InactiveUS20110103472A1Low data rateIncrease data rateColor television with pulse code modulationColor television with bandwidth reductionContent formatHigh bandwidth

Systems, devices and methods are implemented for compressing high-definition video content. Consistent with one such implementation, a device is implemented for preparing a media stream containing high-definition video content for transmission over a transmission channel. A receiver unit is arranged to receive the media stream in a high-definition encoding format that does not compress the high-definition video content contained therein. A decoder unit is arranged to decode the media stream. A compression unit is arranged to compress the decoded media stream to produce a compressed media stream. An encapsulation unit is arranged to encapsulate the compressed media stream within an uncompressed video content format. An encoding unit is arranged to encode the encapsulated media stream using the high-definition format to produce a data stream and may be arranged to encrypt the data stream, e.g., using High-Bandwidth Digital Content Protection (HDCP).

Owner:NXP BV

Waste rubber tyre powder modified asphalt and its prepn process

InactiveCN101089049AInhibition of segregationAvoid elastic recoveryBuilding insulationsPolymer scienceWaste rubber

The present invention relates to one kind of waste rubber tyre powder modified asphalt and its preparation process. The waste rubber tyre powder modified asphalt consists of asphalt matrix 100 weight portions, waste rubber tyre powder 10-30 weight portions, compatilizer 1-10 weight portions, dissolution promoter 0.5-30 weight portions, activating modifier 1-40 weight portions and emulsifier 0-5 weight portions. It is prepared through a chemical and physical process including the steps of degrading and activating the waste rubber tyre powder, vulcanizing and cross-linking, stirring and shearing. It is suitable for paving and repairing highway.

Owner:SHANGHAI MIRONGKE ELECTRICAL DIGITAL INTEGRATION

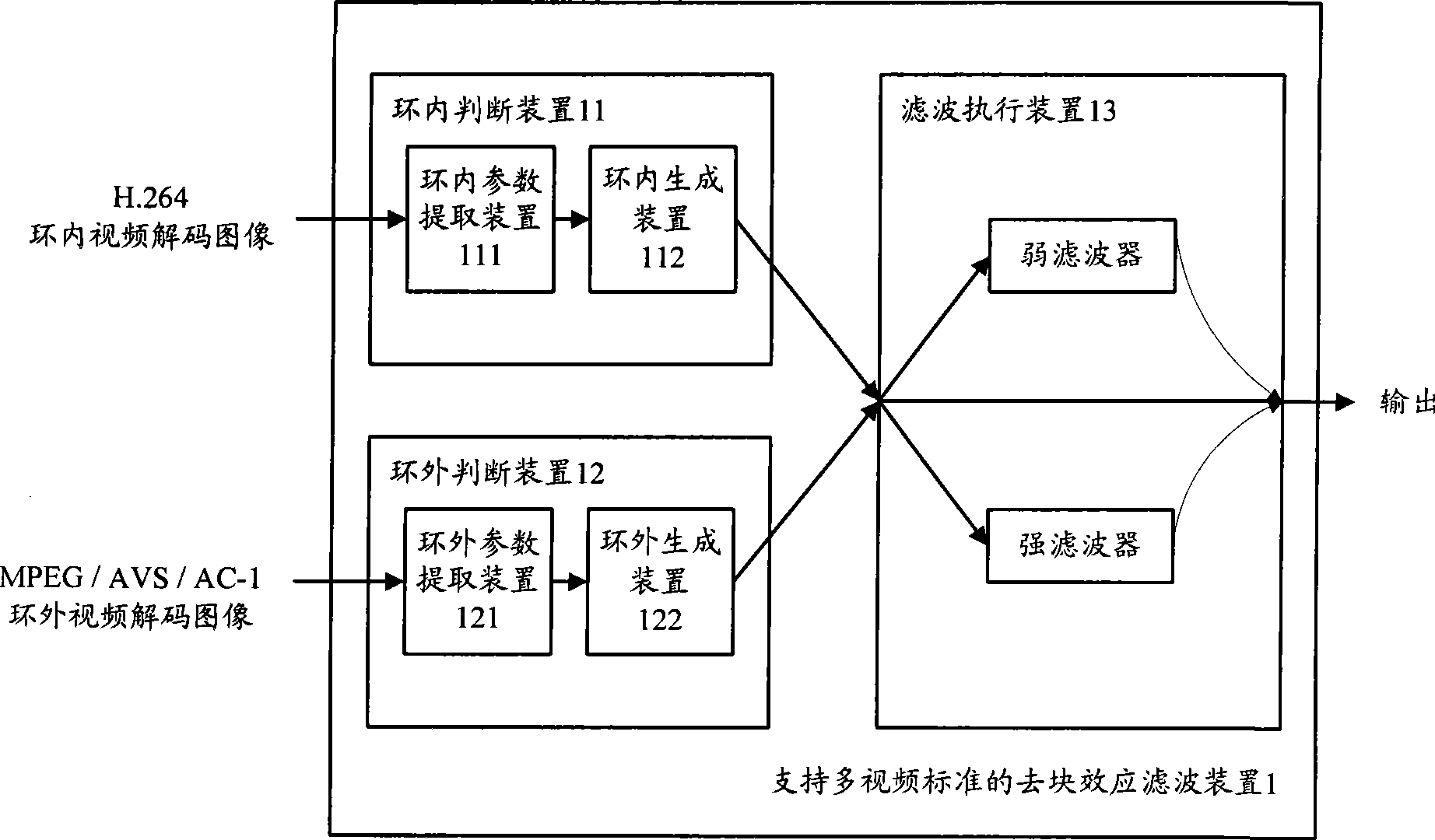

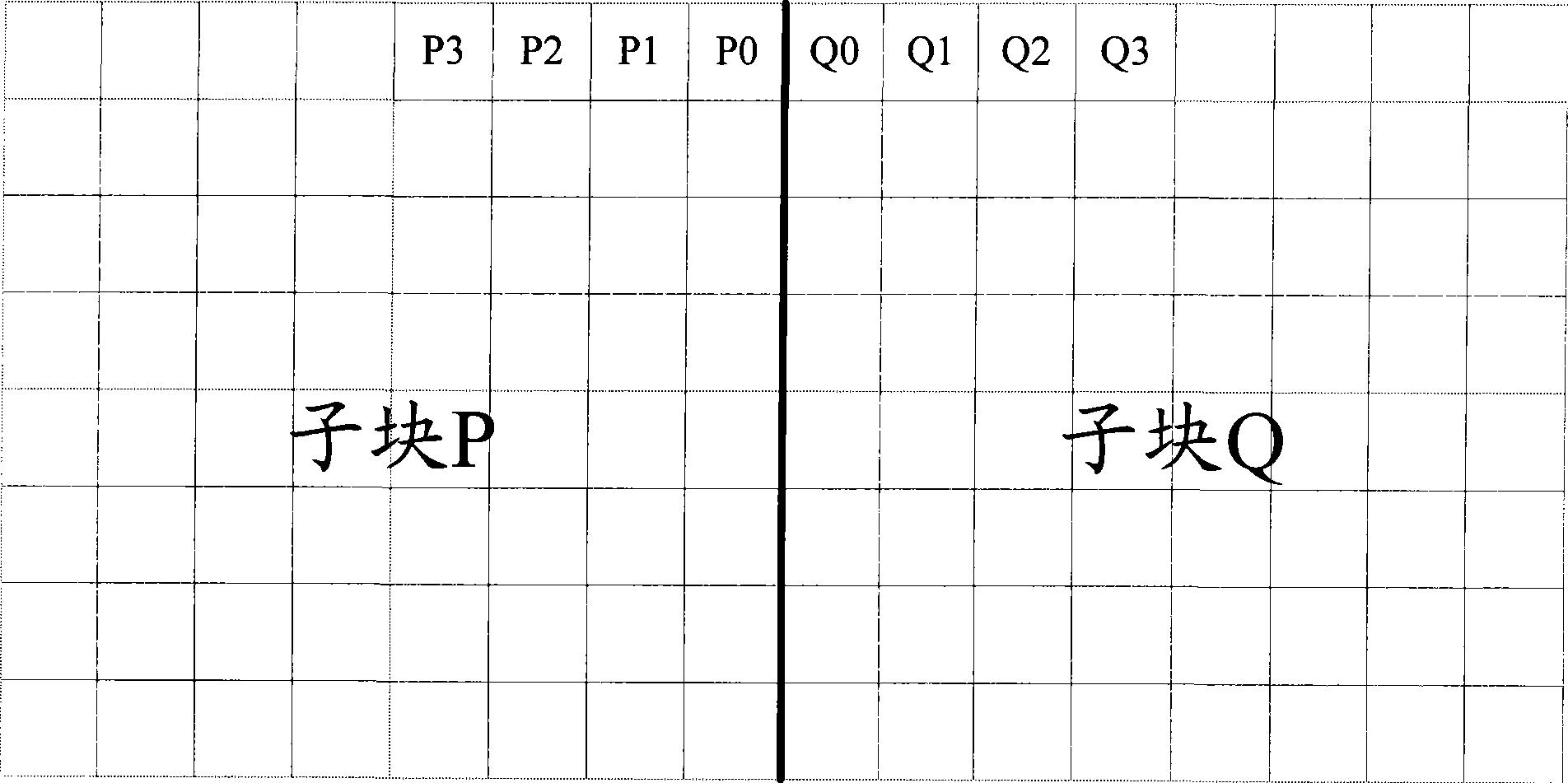

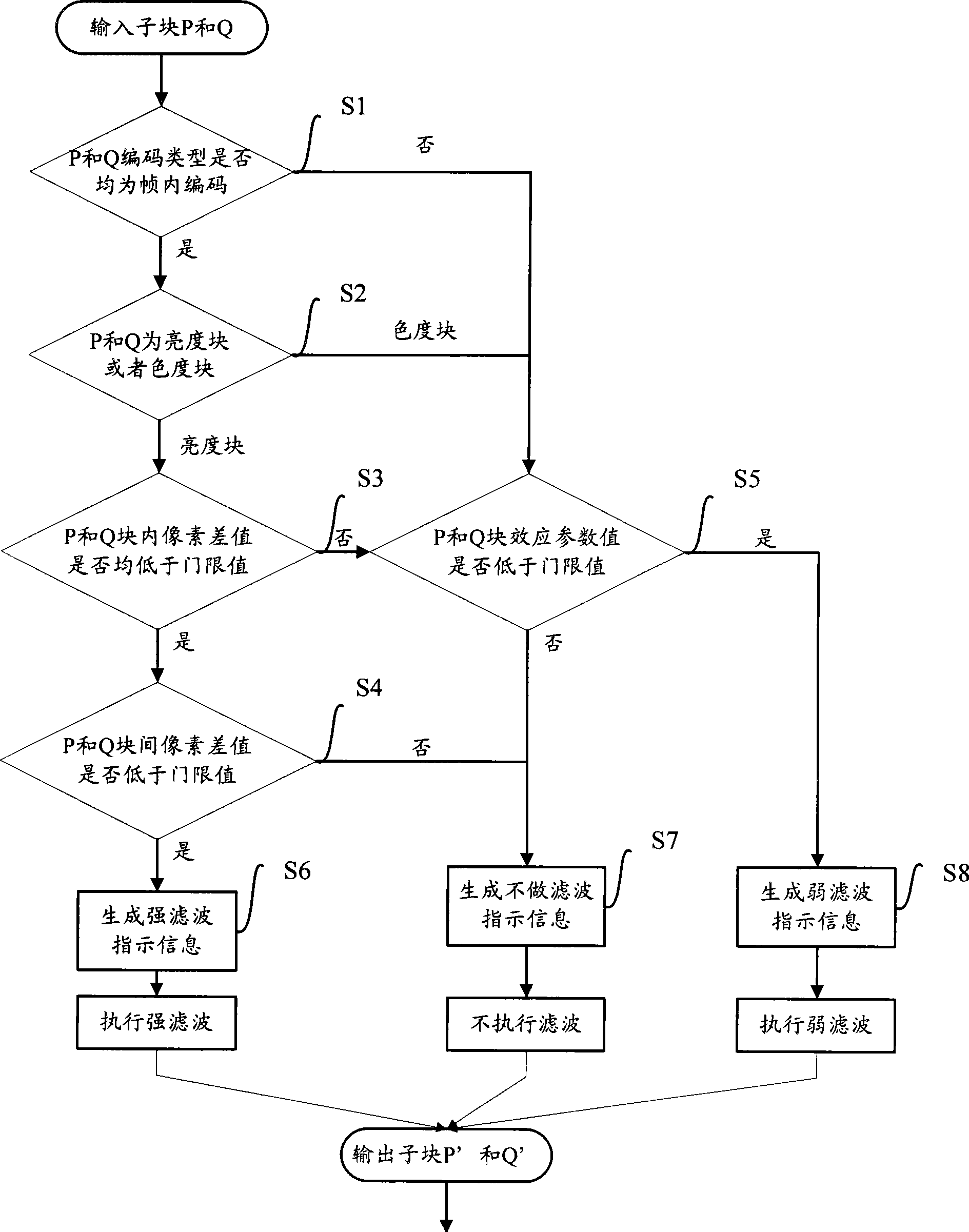

De-block effect filter capable of supporting multi-video standard

InactiveCN101472175ALow costImprove visual qualityTelevision systemsDigital video signal modificationLoop filterBlock effect

The invention provides a device for realizing the in-loop de-blocking filter and out-loop de-blocking filter of the video-decoding image by adopting a loop filter in an H.264 video coding and decoding system. The invention further provides a set of control methods used for choosing the filters which execute relevant strength according to the out-loop video image information. Through the adoption of the loop filter circuit of the H.264 video decoding system, the invention realizes the support for the in-loop de-blocking filter function and the out-loop de-blocking filter function in a multi-video standard system, reduces the cost of the circuit hardware, and provides the good de-blocking performance so as to improve the visual quality of a user.

Owner:CHIPNUTS TECH INC

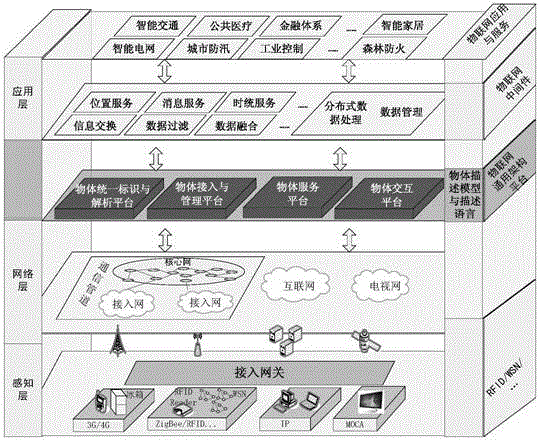

Internet of things system

ActiveCN104640237AEasy constructionAvoid duplicationNetwork topologiesTransmissionTechnology developmentProtocol Application

The invention discloses an Internet of things system which comprises a sensing layer, a network layer, an application layer and an Internet of things general architecture platform layer. The Internet of things general architecture platform layer comprises an object description model and description language unit, an object identify unifying and parsing platform, an object access and management platform, an object service platform and an object interaction platform. Top-layer design of Internet of things architecture platform is carried out for Internet of things architecture platforms, so that technology development of Internet of things can be planned from the top layer, a standard system is led to be established, and construction of an application system of the Internet of things is promoted; unified guidance can be established for development of the Internet of things, reconstruction is avoided, construction cost is lowered, and deployment speed is increased.

Owner:NO 15 INST OF CHINA ELECTRONICS TECH GRP

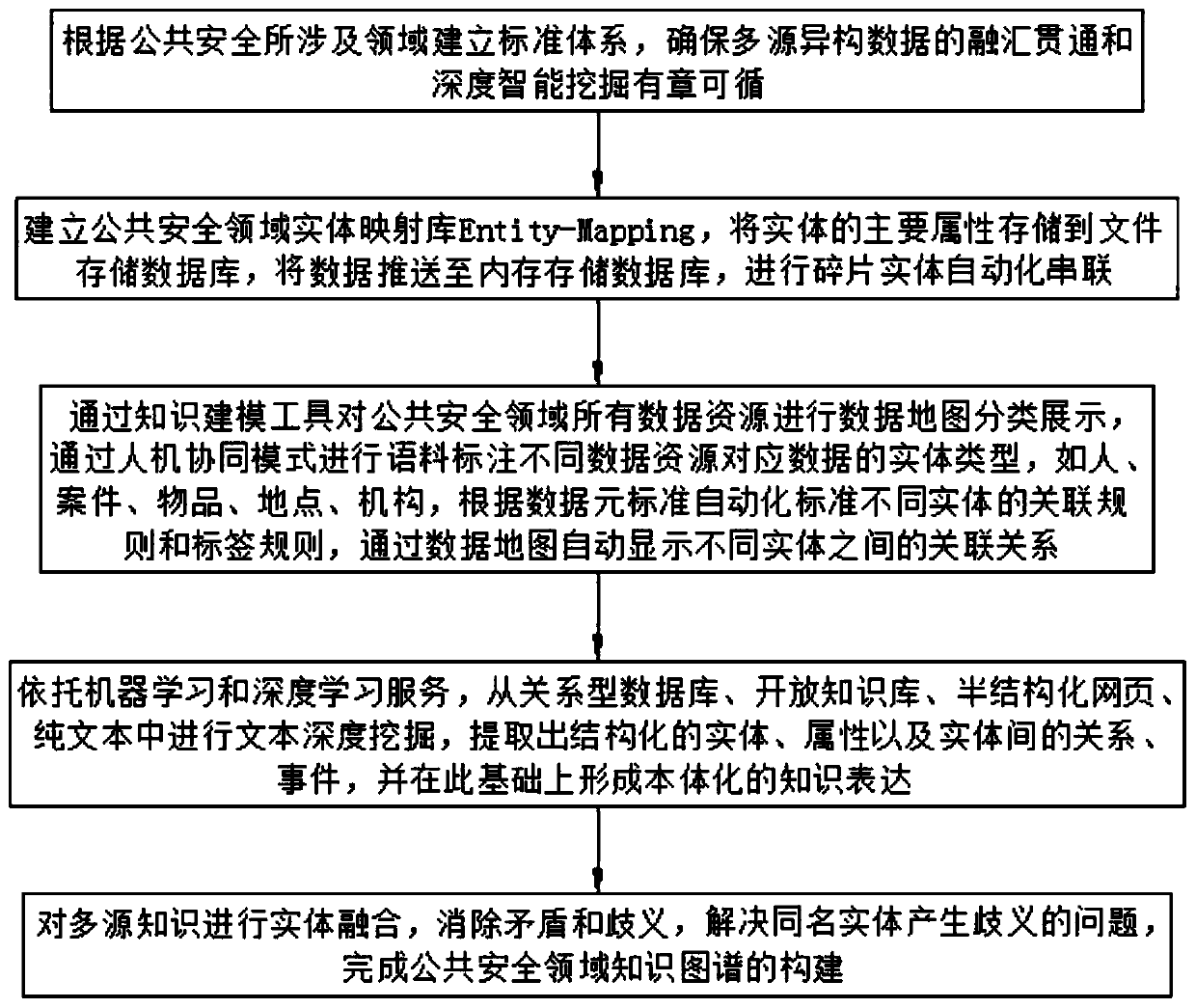

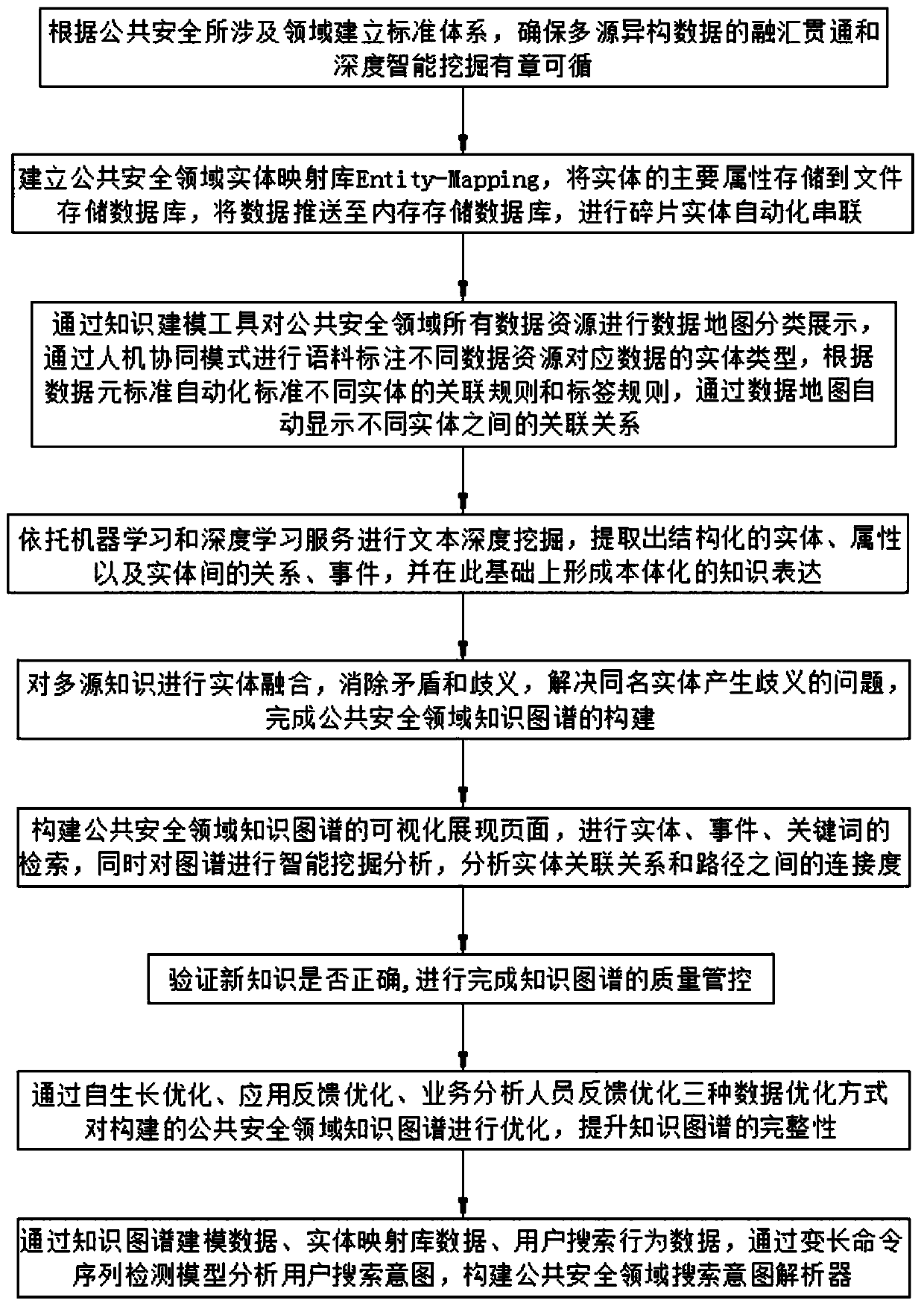

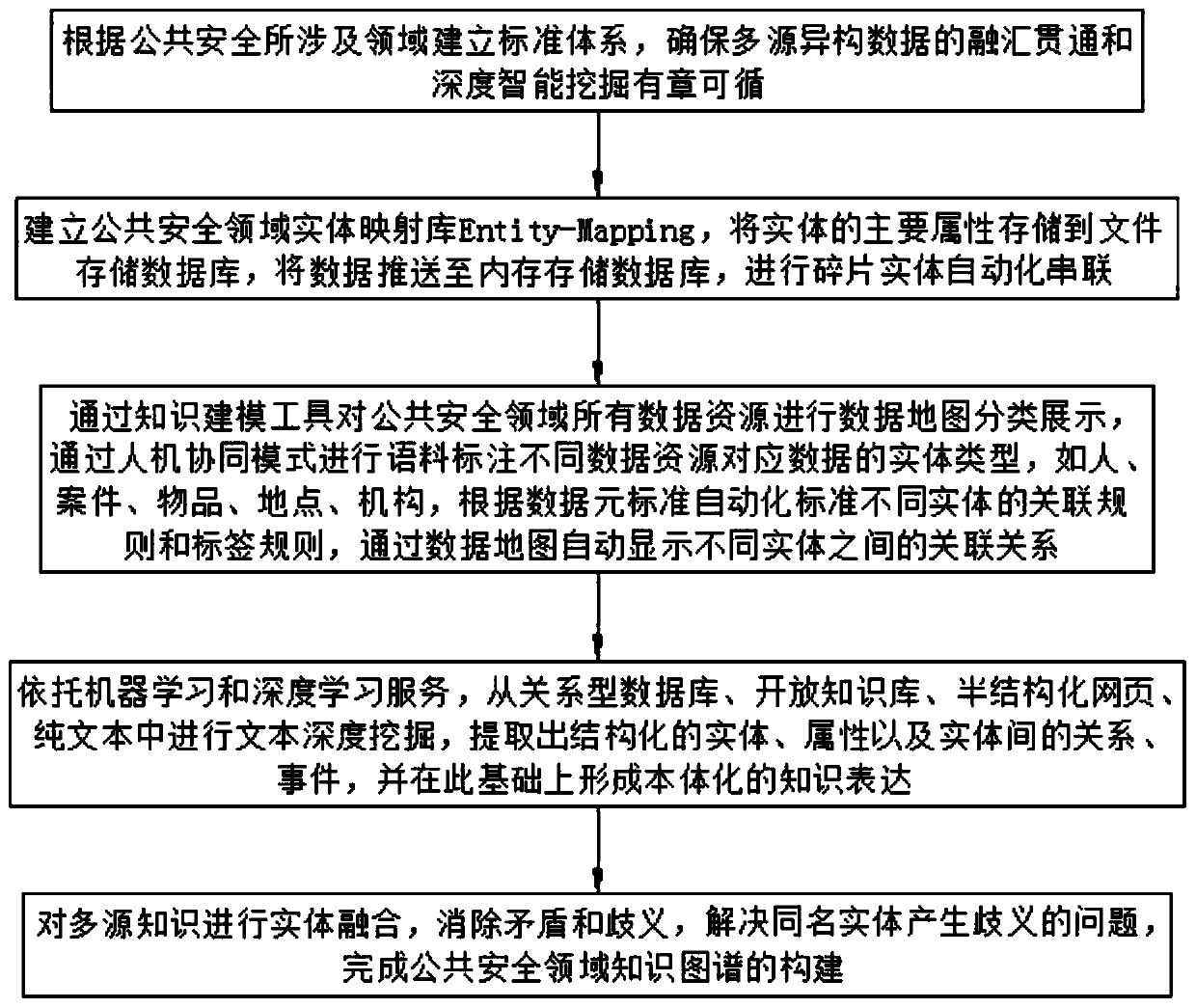

An automatic construction method for a big data knowledge graph in the field of public security

ActiveCN109710701APromote search intelligent recommendationImprove the efficiency of searching for effective informationDatabase modelsData abstractionQuality control

The invention discloses an automatic construction method for a big data knowledge graph in the public security field, relates to the technical field of data mining and artificial intelligence, and comprises the following steps: firstly, establishing a standard system for the public security field, and then establishing an Entity-mapping library in the public security field; storing the main attributes of the entities into a file storage database; pushing the data to a memory storage database, carrying out automatic series connection on fragmented entities, abstracting the data into three categories of entities, relations and events after the previous preparation work is finished, and sequentially finishing automatic construction of the public security field knowledge map by virtue of machine learning and deep learning services through knowledge modeling, knowledge extraction and entity fusion; Besides, the automatic construction capability is realized, the quality control and optimization of the knowledge graph are carried out, the public security field search intention analyzer is constructed, the intelligent recommendation of the user search is promoted, and the efficiency of obtaining effective information by the user search is improved.

Owner:INSPUR SOFTWARE CO LTD

Dynamically and customizably managing data in compliance with privacy and security standards

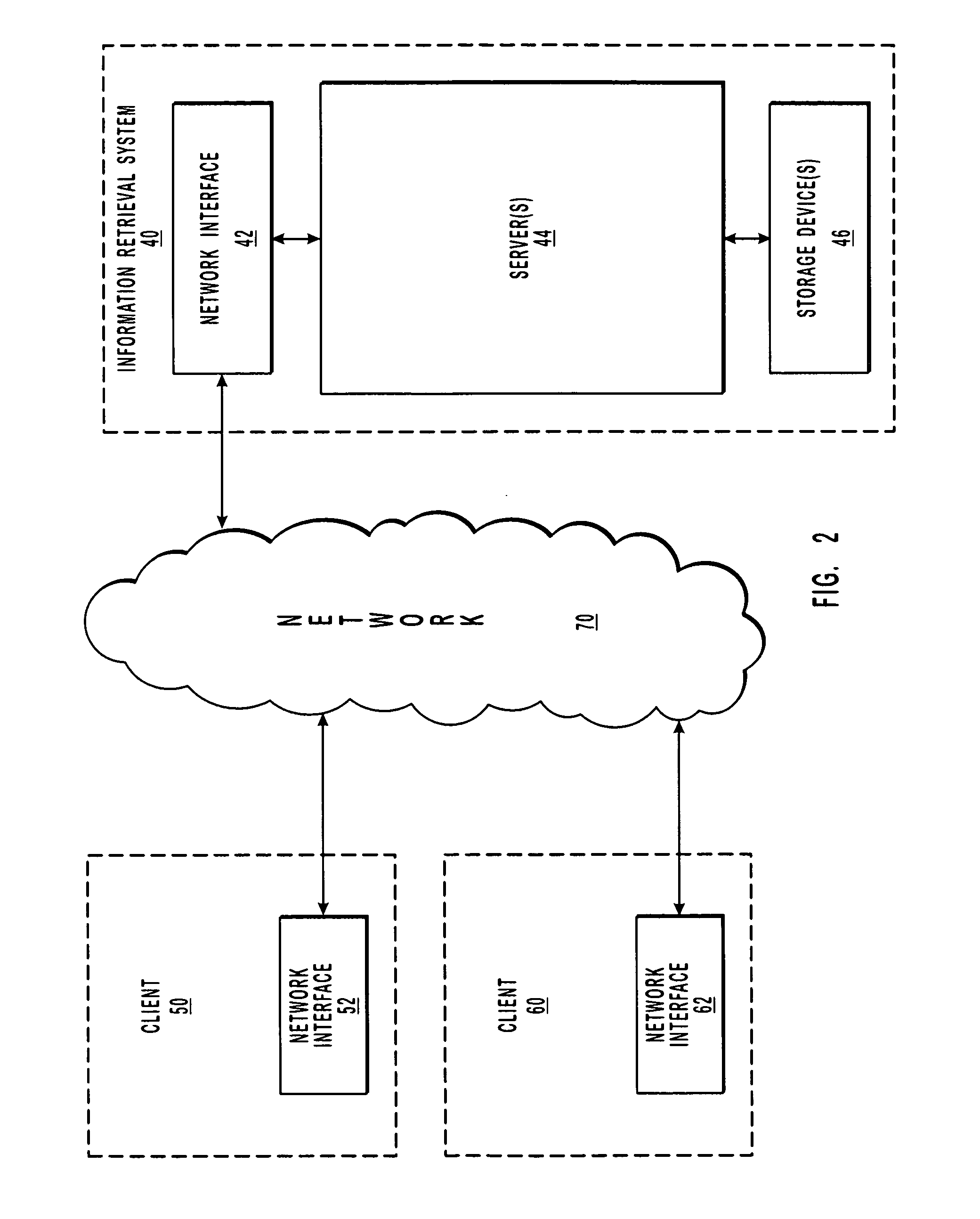

InactiveUS20050192830A1Preserving professional confidenceAvoid identificationComputer security arrangementsPayment architectureDocumentation procedureRecordset

Systems and methods for managing data in compliance with privacy, security and / or retention standards in business industries. A dynamic and customizable archival and retrieval system allows for information and documentation to be placed and made available in the system. The document type and identifying information for that document type are described. Definitions are established for the documents being managed, the data identifying the documents, and the retention policies for the documents. The documents are associated with the identifying data for a particular set of records. A single point of entry is provided for external and / or internal requests, and / or a single point of exit is provided for transmissions of information, wherein the transmissions to requestors include information that is individually approved. Moreover, digital authorizations and consents for retrieval from external data sources may be utilized.

Owner:VERISMA SYST

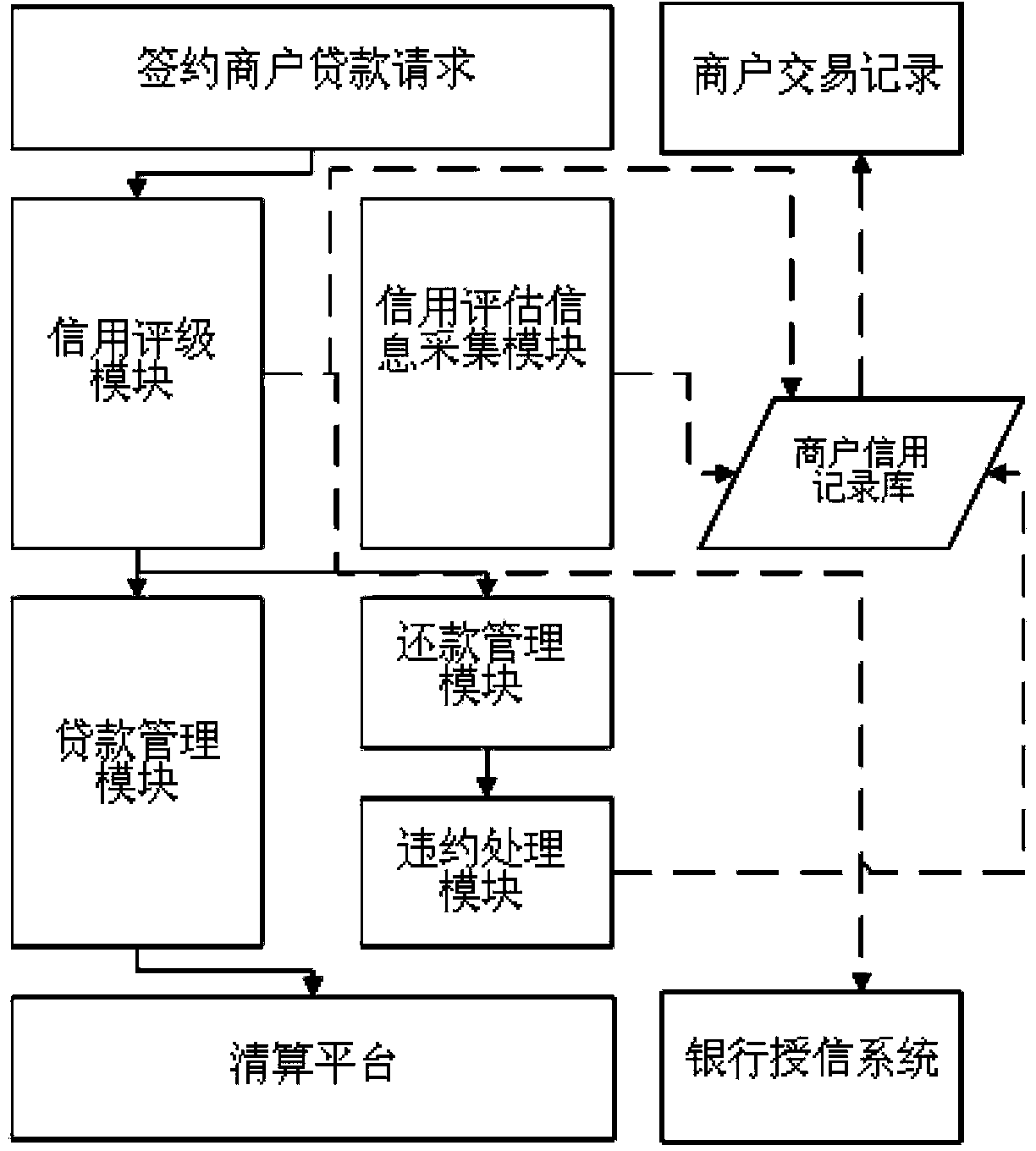

Middle-and-small-sized enterprise reputation and financing credit standard system for non-face-to-face trading

The invention relates to a middle-and-small-sized enterprise reputation and financing credit standard system for non-face-to-face trading. The middle-and-small-sized enterprise reputation and financing credit standard system for the non-face-to-face trading comprises a credit assessment information collection module, a credit rating module, a loan management module, a repayment management module and a default management module. The middle-and-small-sized enterprise reputation and financing credit standard system for the non-face-to-face trading determines the limit of a loan mainly according to assessment, through data accumulated by the middle-and-small-sized enterprise reputation and financing credit standard system, of the reputation of an applicant, carries out integration processing on evaluation records of history trading of a seller and the situation of receivables in a implementation picking system, carries out connection between integrated information and enterprise credit granting systems of banks or other financial institutions, provides loan convenience of flexible loans for the seller, and provides a reliable credit standard for credit agencies. According to the middle-and-small-sized enterprise reputation and financing credit standard system for the non-face-to-face trading, due to the fact that a flexible repayment mechanism is set for repayment of the loans, amortization can be achieved, bullet repayment can also be achieved, the original offline loan mode is replaced by the on-line loan mode, a middle side credit evaluation system is connected with the banks and other financial institutions, diversification configuration of the repayment mode is achieved, and a repayment can be directly deducted to carry out fund settlement through repayment channels.

Owner:通联支付网络服务股份有限公司

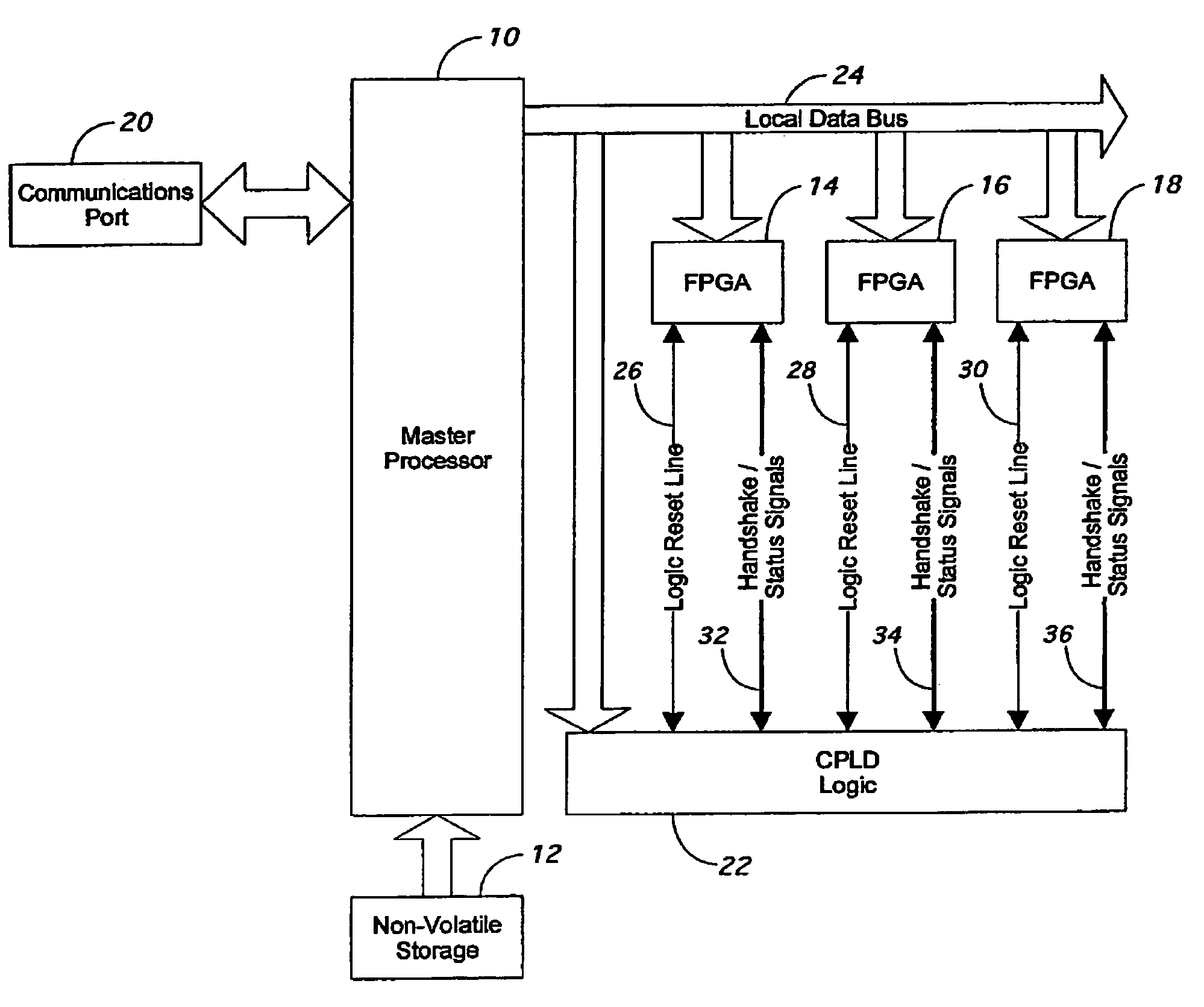

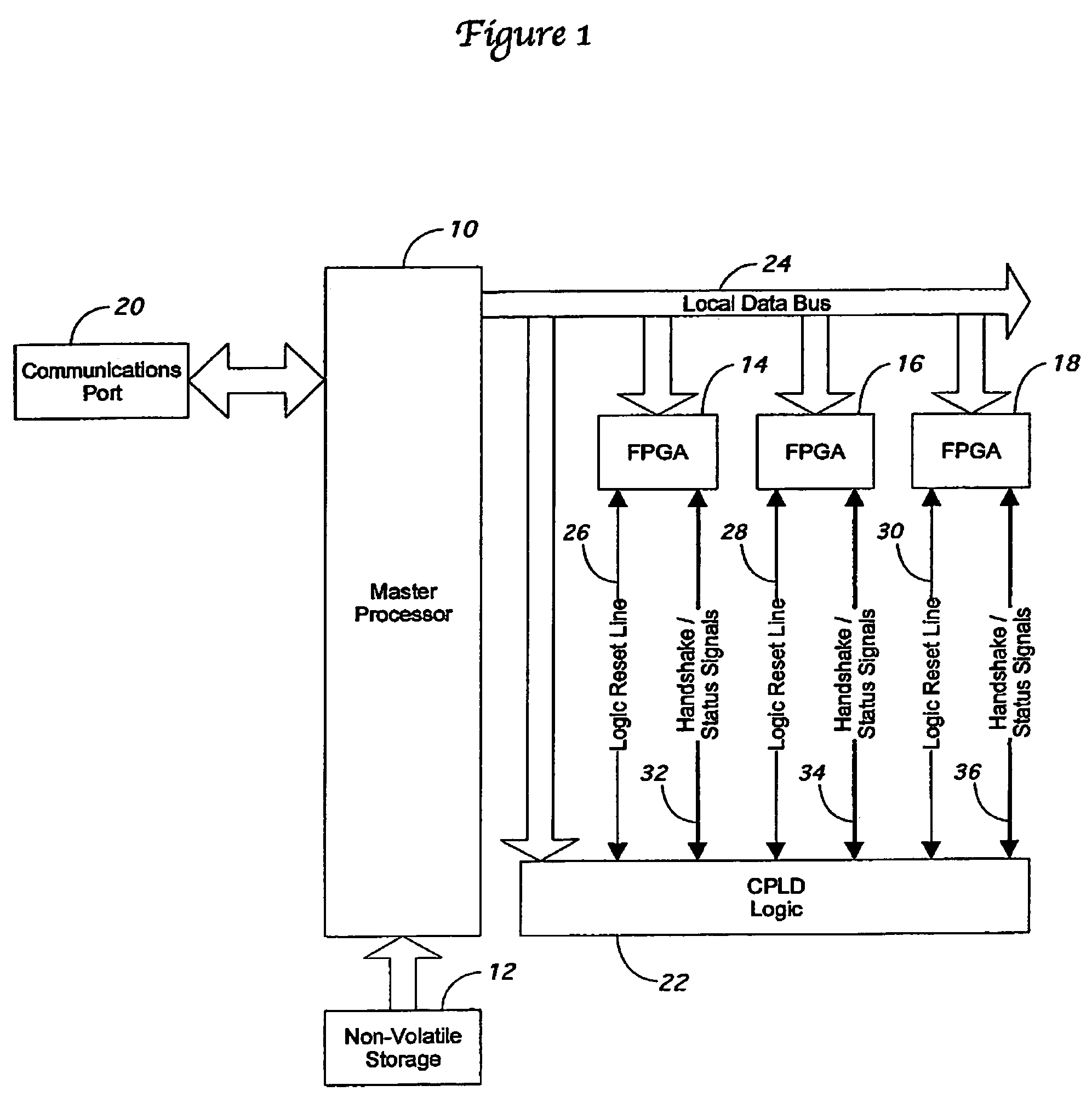

Method and apparatus for configuring a programmable logic device

InactiveUS7146598B2Minimal numberDrain can be reducedElectronic circuit testingData resettingProgrammable logic deviceErasable programmable logic device

A method and apparatus for configuring multiple first programmable logic devices from a single memory includes a microprocessor, and a second programmable logic device containing the interface logic for the first programmable device and the microprocessor. The present invention allows multiple FPGAs to be programmed from a single memory structure under the control of the microprocessor thereby using fewer components than systems dedicating a separate memory to each FPGA. A communications port allows new configurations to be downloaded to the microprocessor memory. In addition, the present invention can be used in combination with standard systems with each FPGA having its own memory, with the microprocessor being able to select between the central microprocessor memory and the local memory for programming each FPGA.

Owner:MCDATA SERVICES CORP +1

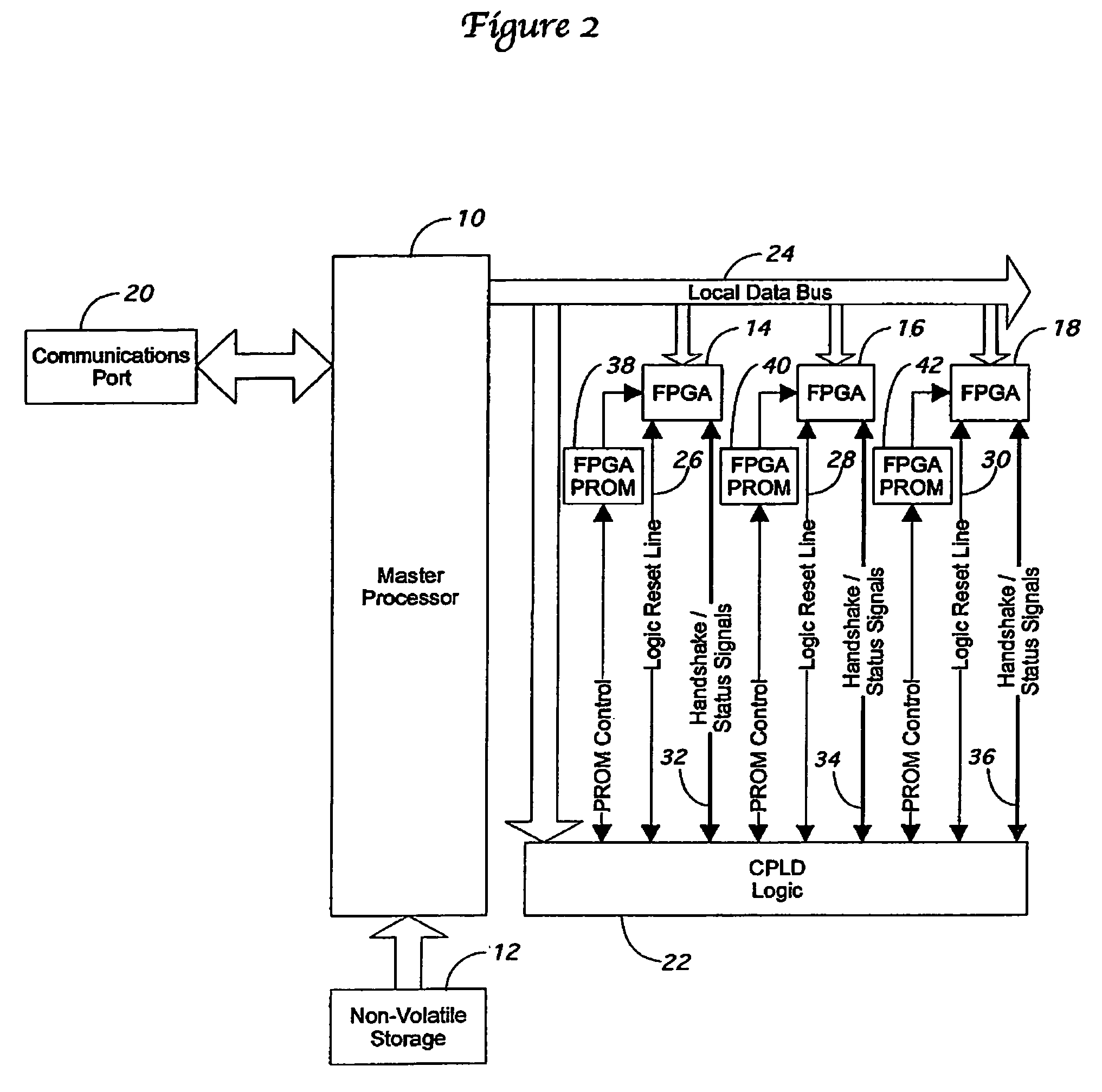

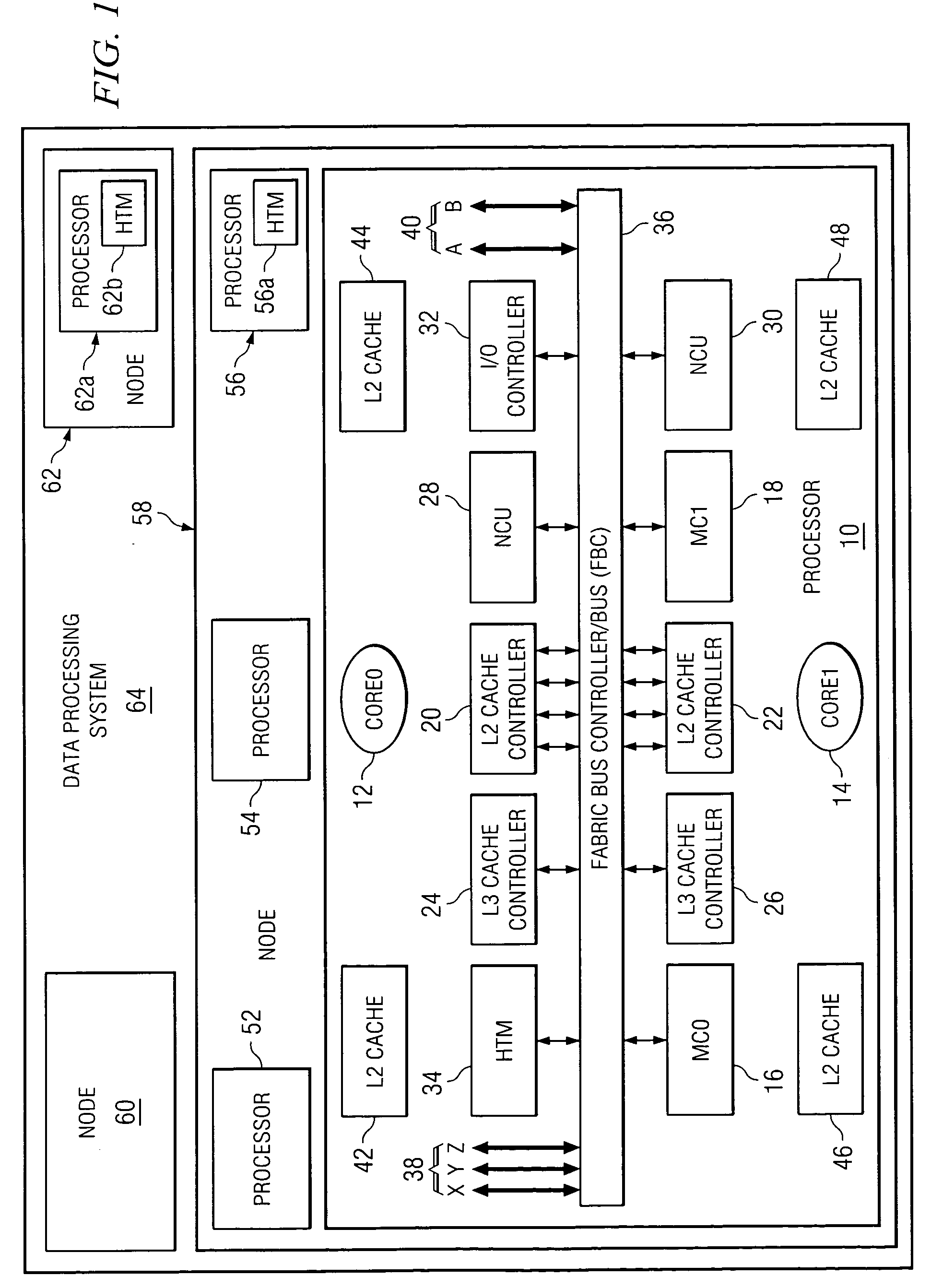

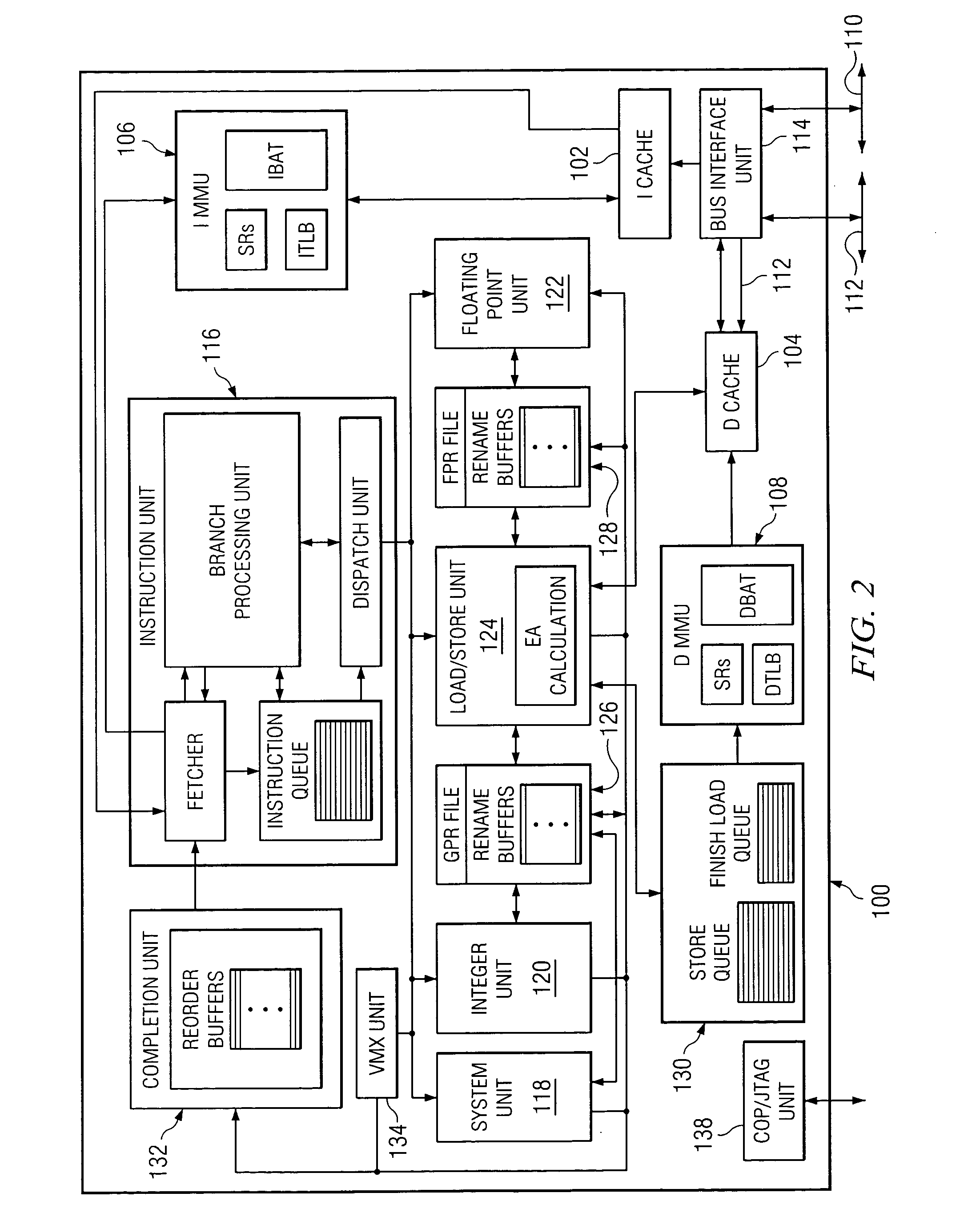

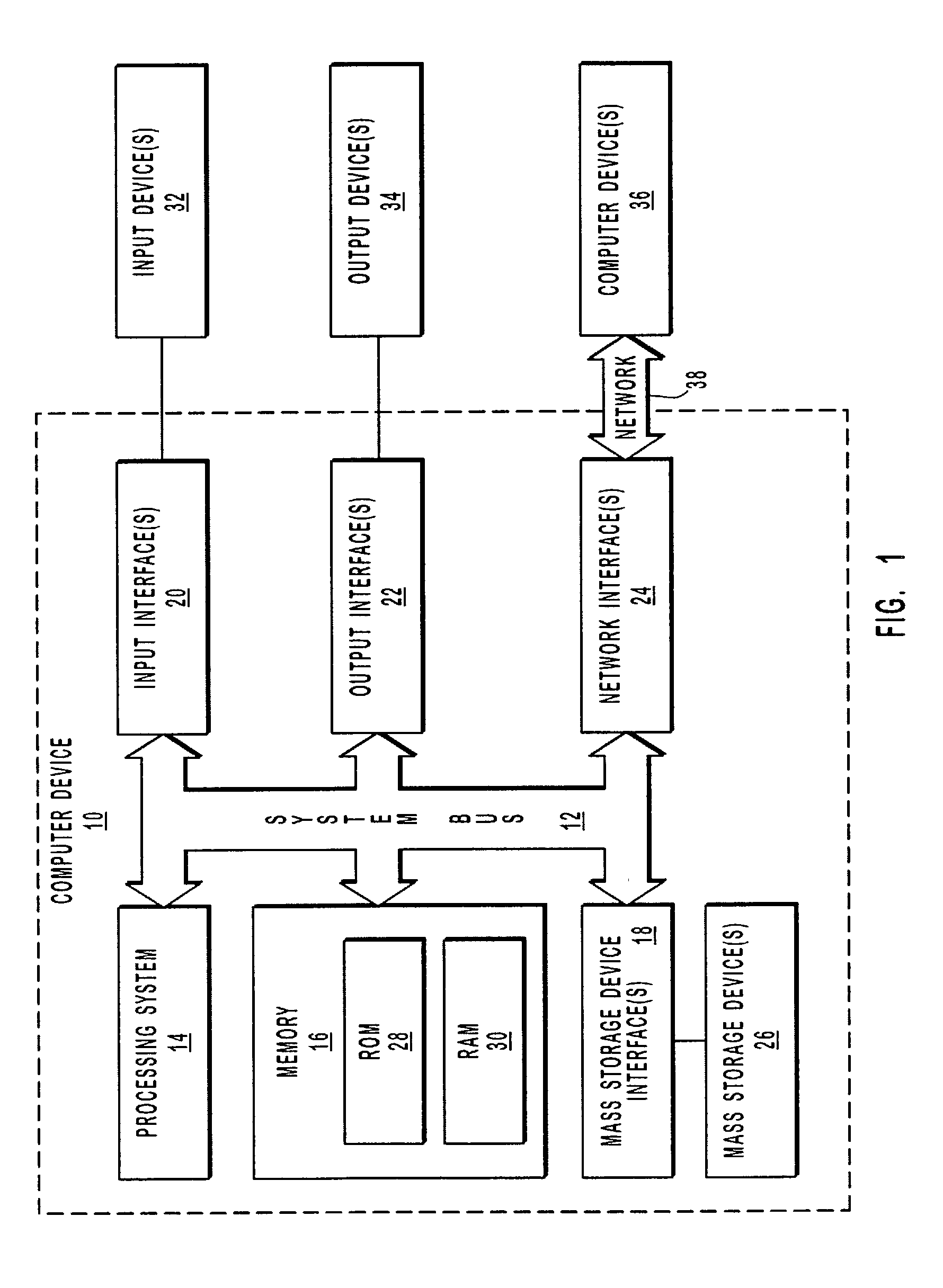

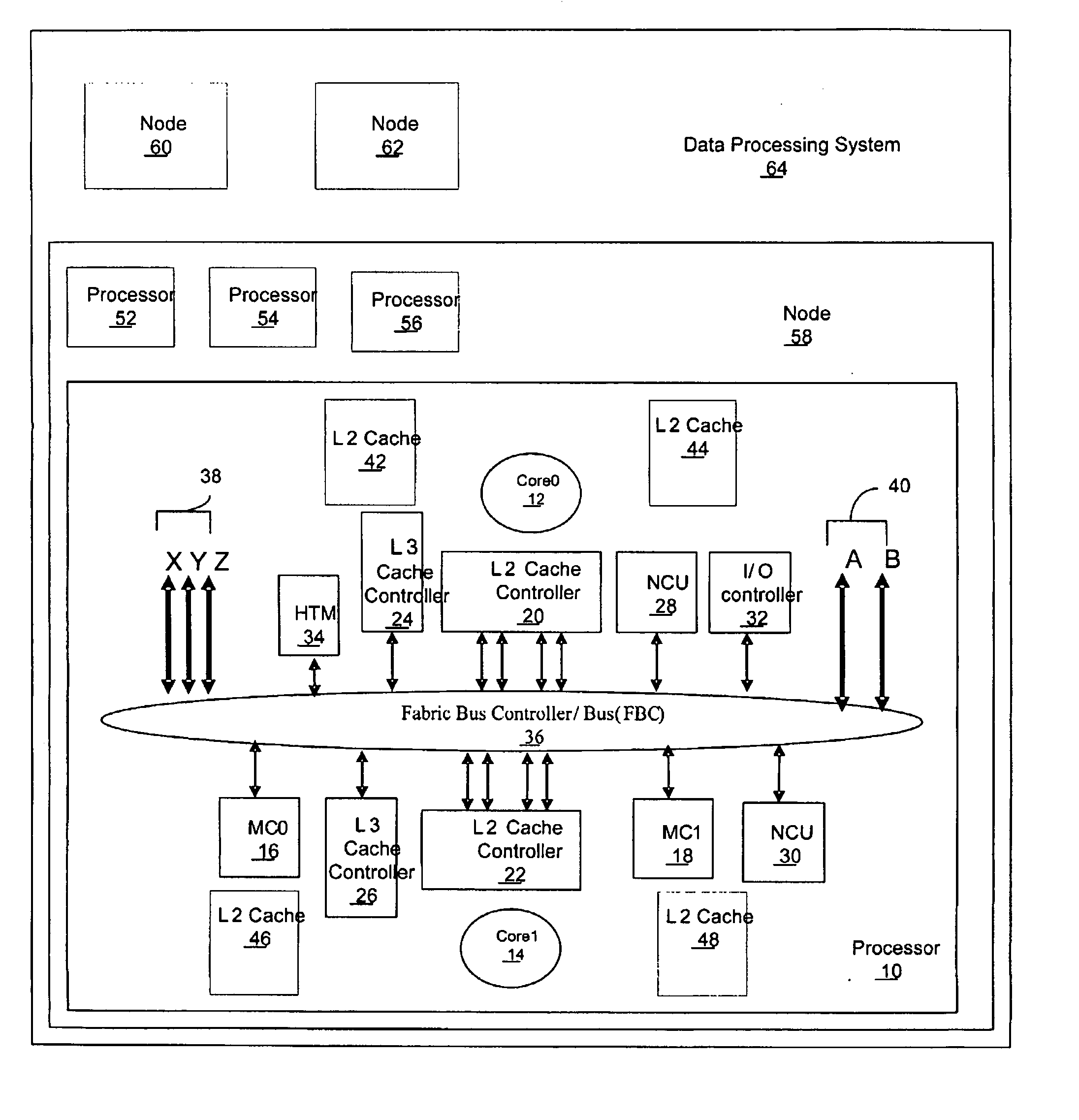

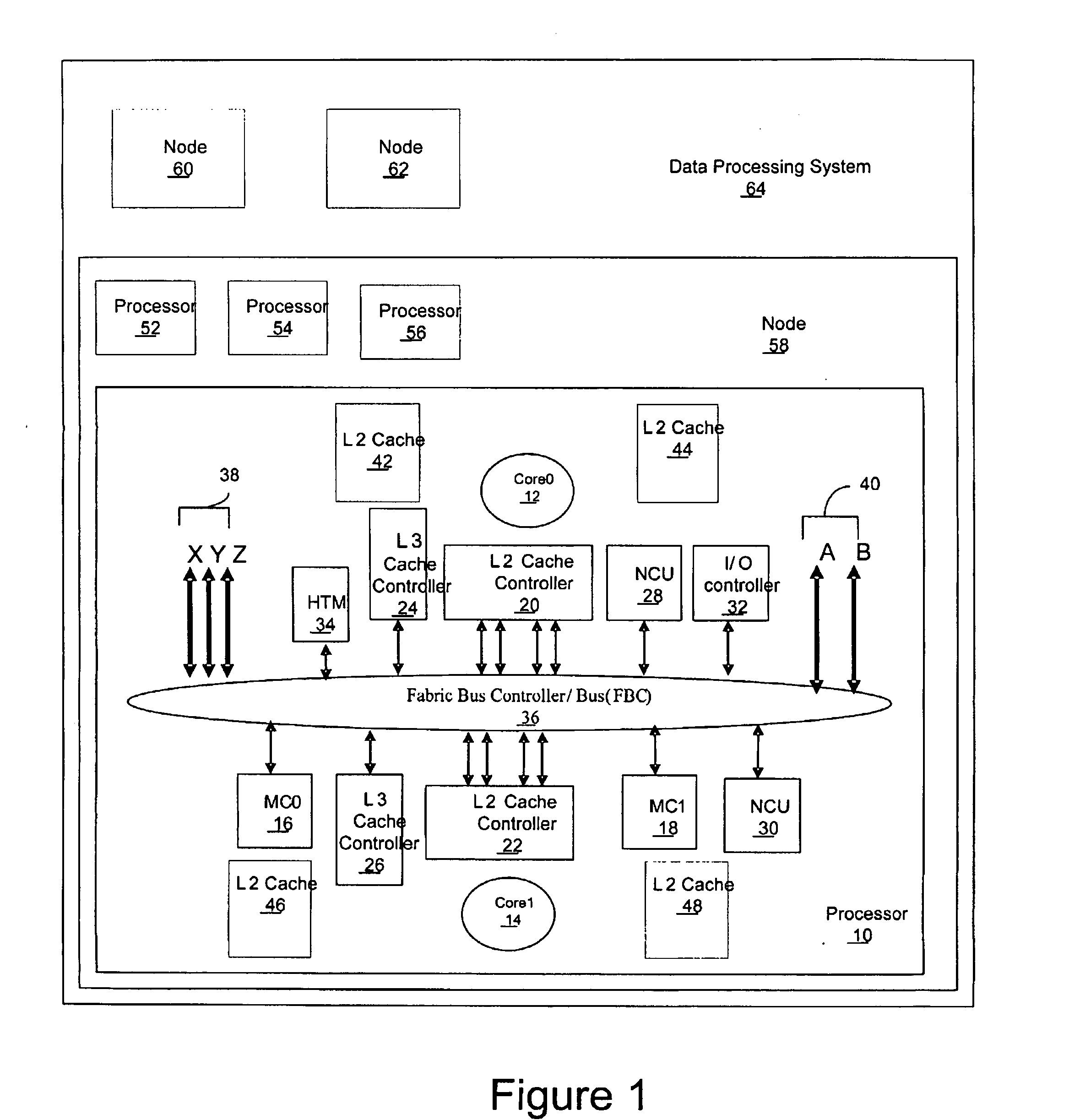

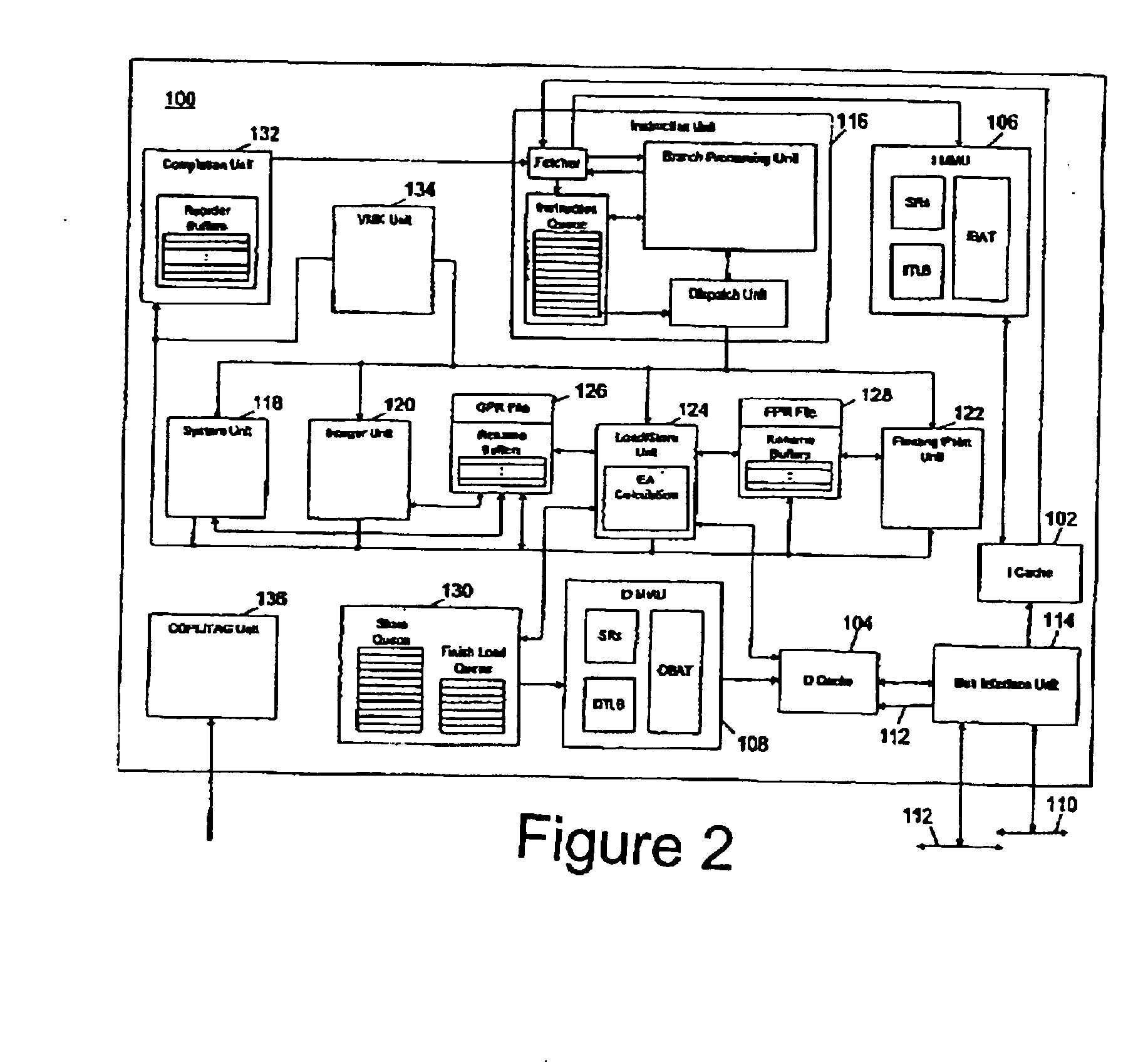

Method, apparatus, and computer program product for synchronizing triggering of multiple hardware trace facilities using an existing system bus

A method, apparatus, and computer program product are disclosed in a data processing system for synchronizing the triggering of multiple hardware trace facilities using an existing bus. The multiple hardware trace facilities include a first hardware trace facility and a second hardware trace facility. The data processing system includes a first processor that includes the first hardware trace facility and first processing units that are coupled together utilizing the system bus, and a second processor that includes the second hardware trace facility and second processing units that are coupled together utilizing the system bus. Information is transmitted among the first and second processing units utilizing the system bus when the processors are in a normal, non-tracing mode, where the information is formatted according to a standard system bus protocol. Trigger events are transmitted to the hardware trace facilities utilizing the same standard system bus, where the trigger events are also formatted according to the standard system bus protocol.

Owner:IBM CORP

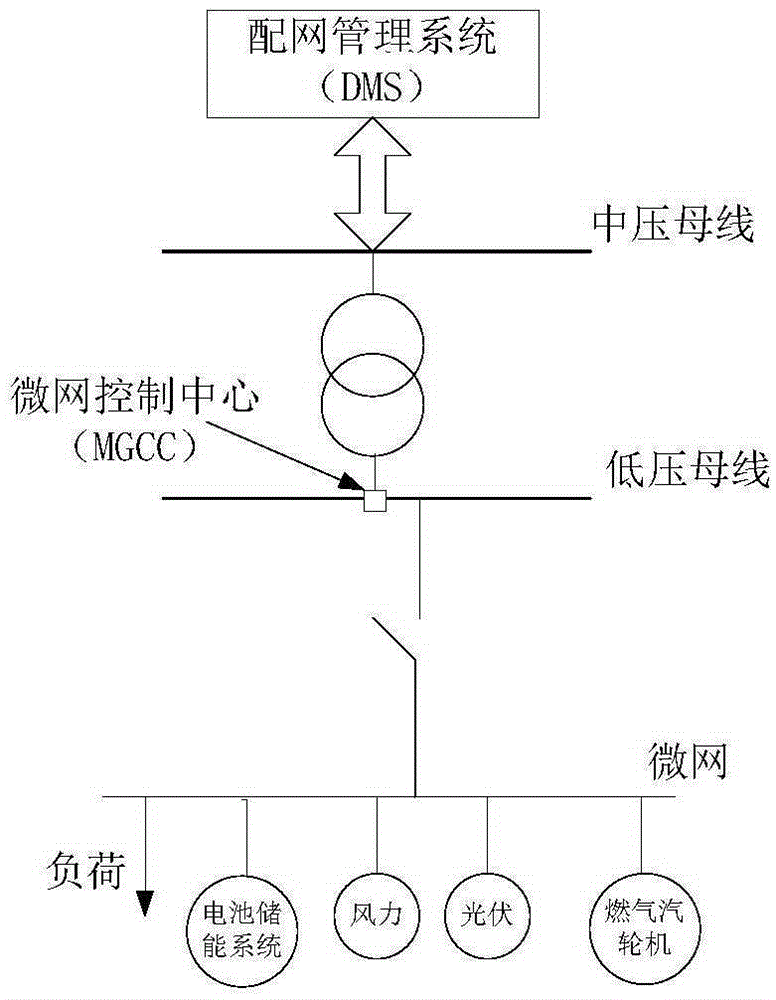

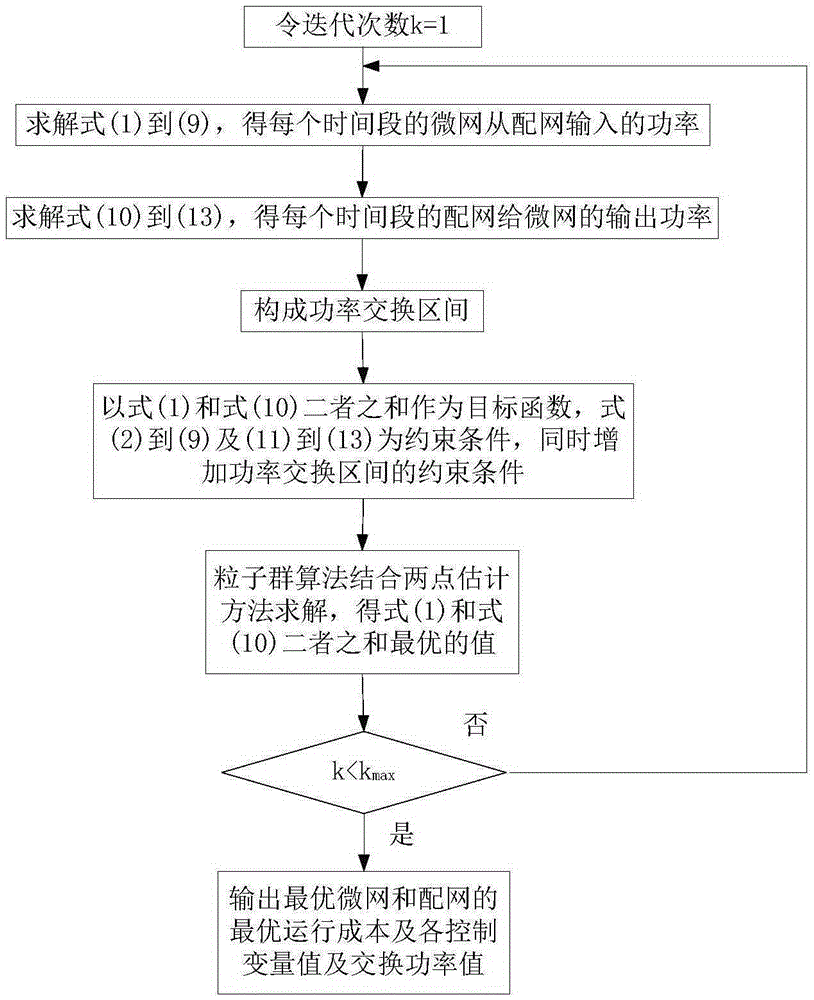

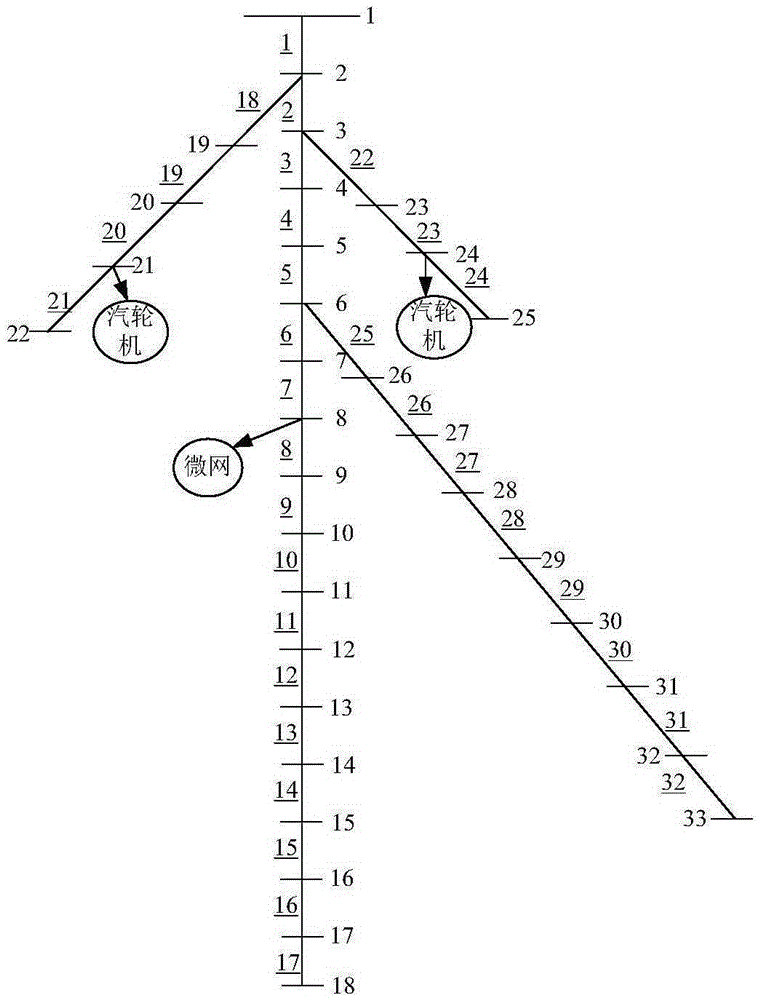

Dynamic random scheduling control method for power distribution network containing micro-grid

ActiveCN105244869AImprove stabilityImprove economic transactionsEnergy industrySingle network parallel feeding arrangementsPower exchangeConstraint programming model

The invention discloses a dynamic random scheduling control method for a power distribution network containing a micro-grid. The method is a dynamic random scheduling control method of comprehensively considering the minimal planned operation cost of the micro-grid and the distribution network. The method comprises the following steps: firstly, respectively building chance-constraint programming models for the minimal expected planned operation cost of the micro-grid and the distribution network, and determining the chance-constraint programming models by a particle swarm optimization algorithm and a two-point estimation method; searching a power exchange value with the minimal comprehensive expected planned operation cost by the particle swarm optimization algorithm according to a power exchange control interval, between the micro-grid and the distribution network, obtained by respective optimization results of the micro-grid and the distribution network, so as to determine the optimal dynamic random scheduling control scheme of the micro-grid and the power distribution network; and finally validating the practicability by an improved IEEE 33 node standard system algorithm.

Owner:ELECTRIC POWER RESEARCH INSTITUTE OF STATE GRID SHANDONG ELECTRIC POWER COMPANY +1

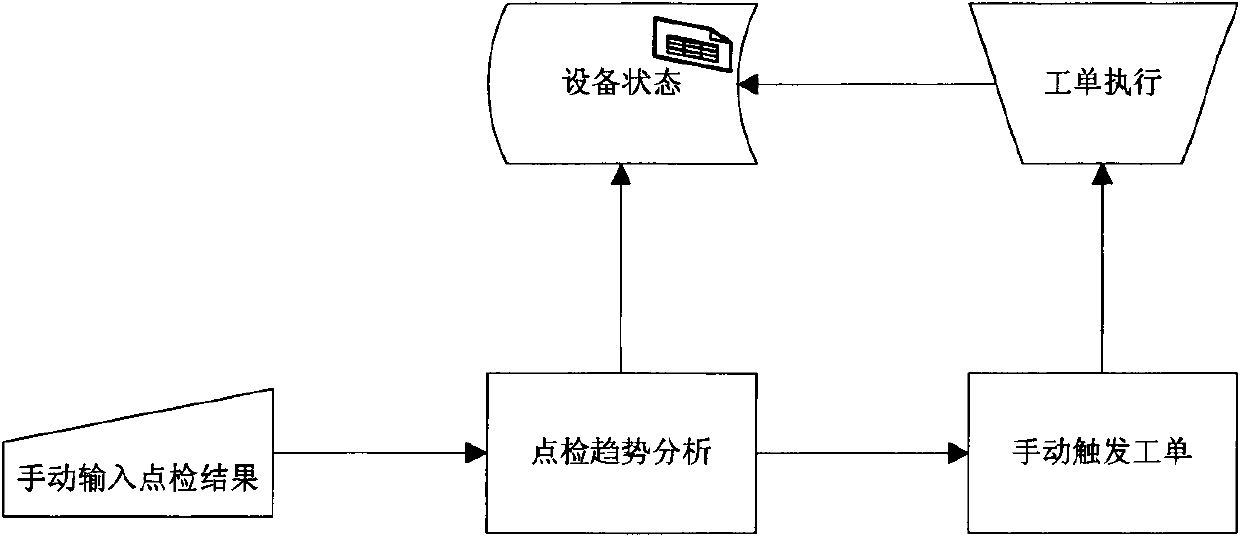

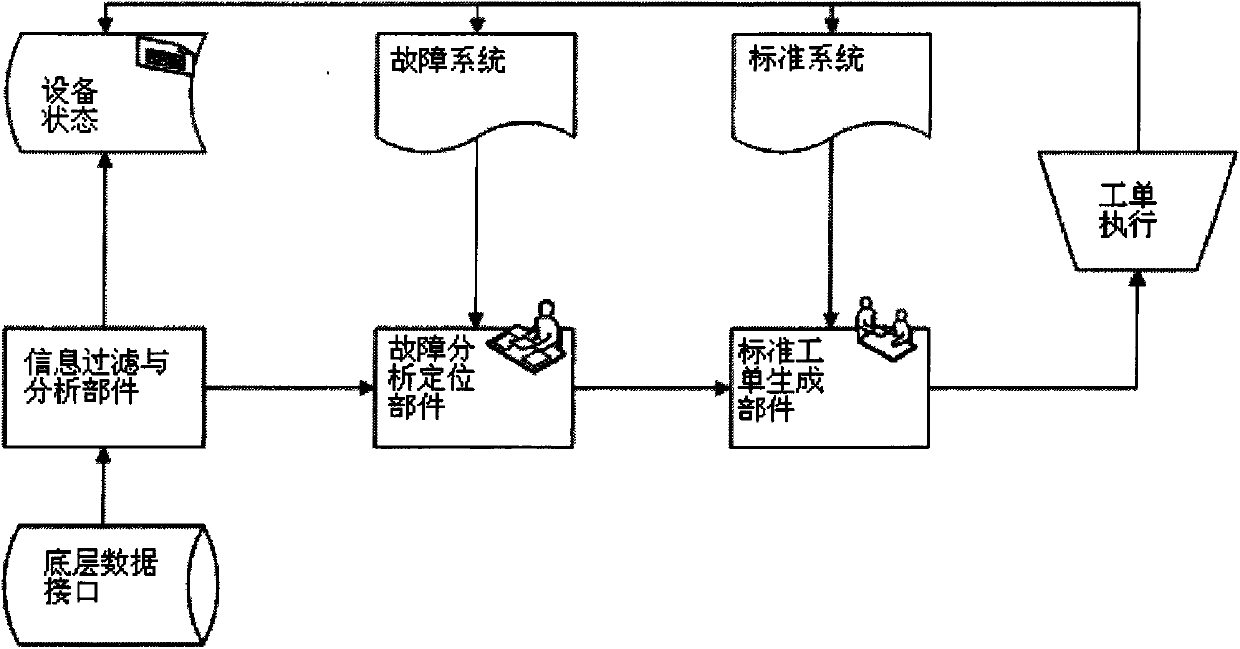

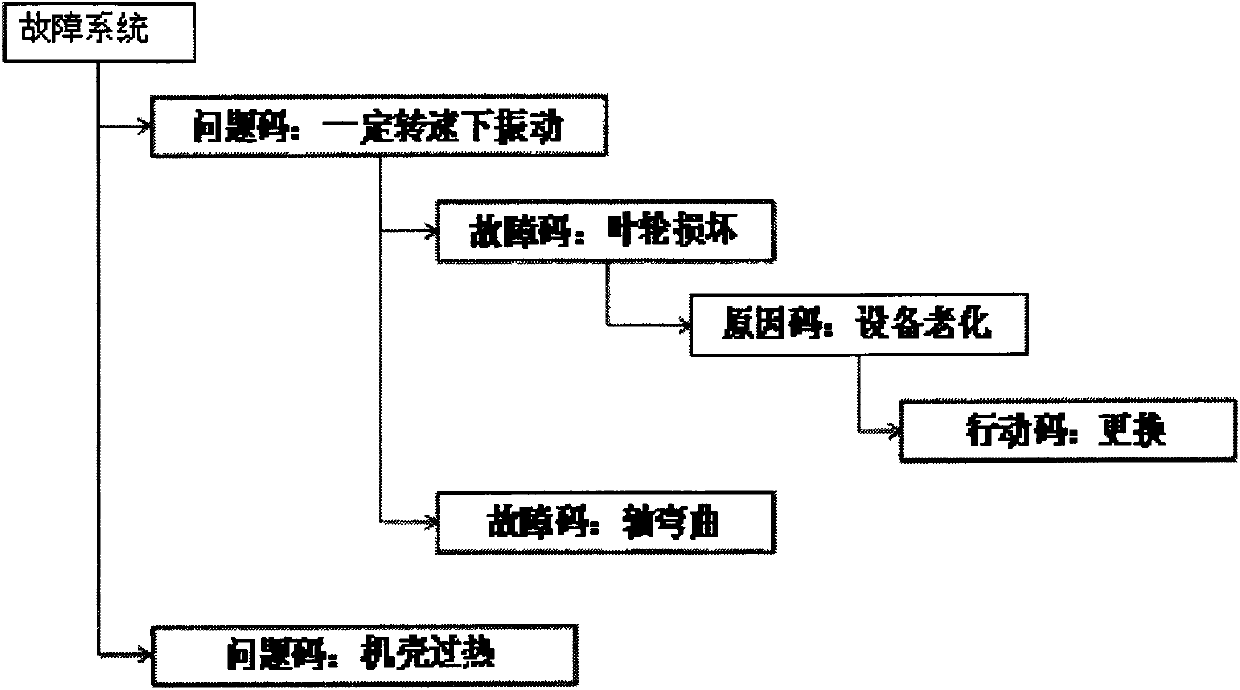

Artificial intelligence maintenance system and method

The present invention discloses an artificial intelligence maintenance system and method, which comprises: the ground floor data interface; the information filtering and analysis part; the fault analysis positioning part connected with the fault system database, according to the data sent from the fault analysis positioning part, finding the failure cause from the fault system database and sending the related fault information to the standard work-order generation part; the standard work-order generation part connected with the standard system database, according to the fault information, finding the standard operation of fault processing from the standard system database to determine whether automatically to trigger the standardization of work-order. The invention accurately positions the failure cause by means of the fault analysis positioning part based on the fault system, and rapidly gives the suggestion for fault processing. Moreover, according to the standard work part, the invention can timely complete all the operations, manual work, materials and tools that the fault maintenance work needs and implement the suggestion for operation permission of the fault maintenance work, and can release the maintenance work-order in time so as to realize the artificial intelligence maintenance.

Owner:SHANGHAI BAOSIGHT SOFTWARE CO LTD

Method for storing AVS encoding file format for video recorder and video server

InactiveCN101325681AEncoding and storage efficiency is highRapid positioningTelevision system detailsPulse modulation television signal transmissionVideocassette recorderData retrieval

The invention discloses a storage method for AVS coding file format of a video recorder and a video server, comprising defining a file head structure, a data region structure and an index region structure; the file head structure is composed of a file information structure, a media information structure and a content information structure; the data region structure is composed of a data region head information structure and a media data structure; the index region structure is composed of an index region head information structure and an index data structure. The method includes high storage efficiency, a simple technical proposal and low complexity of a chip realization as well as support VCR control and custom data retrieval, which is liable to be popularized, the AVS media storage format can push forward technical standard for AVS integral standard system to have access to the technical field of network security protection, so as to be further applied to intelligent surveillance in computer security protection.

Owner:BEIJING TELESOUND ELECTRONICS

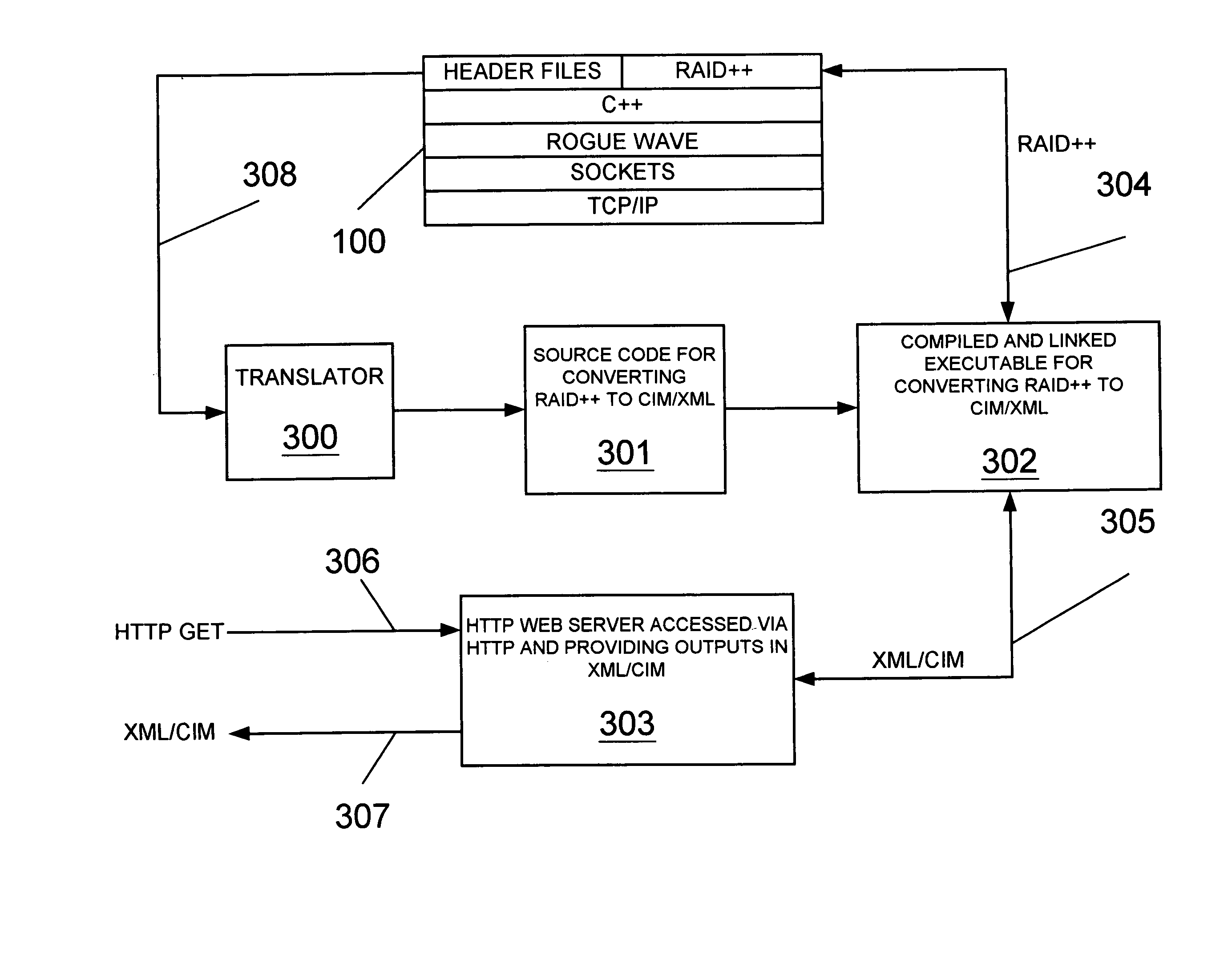

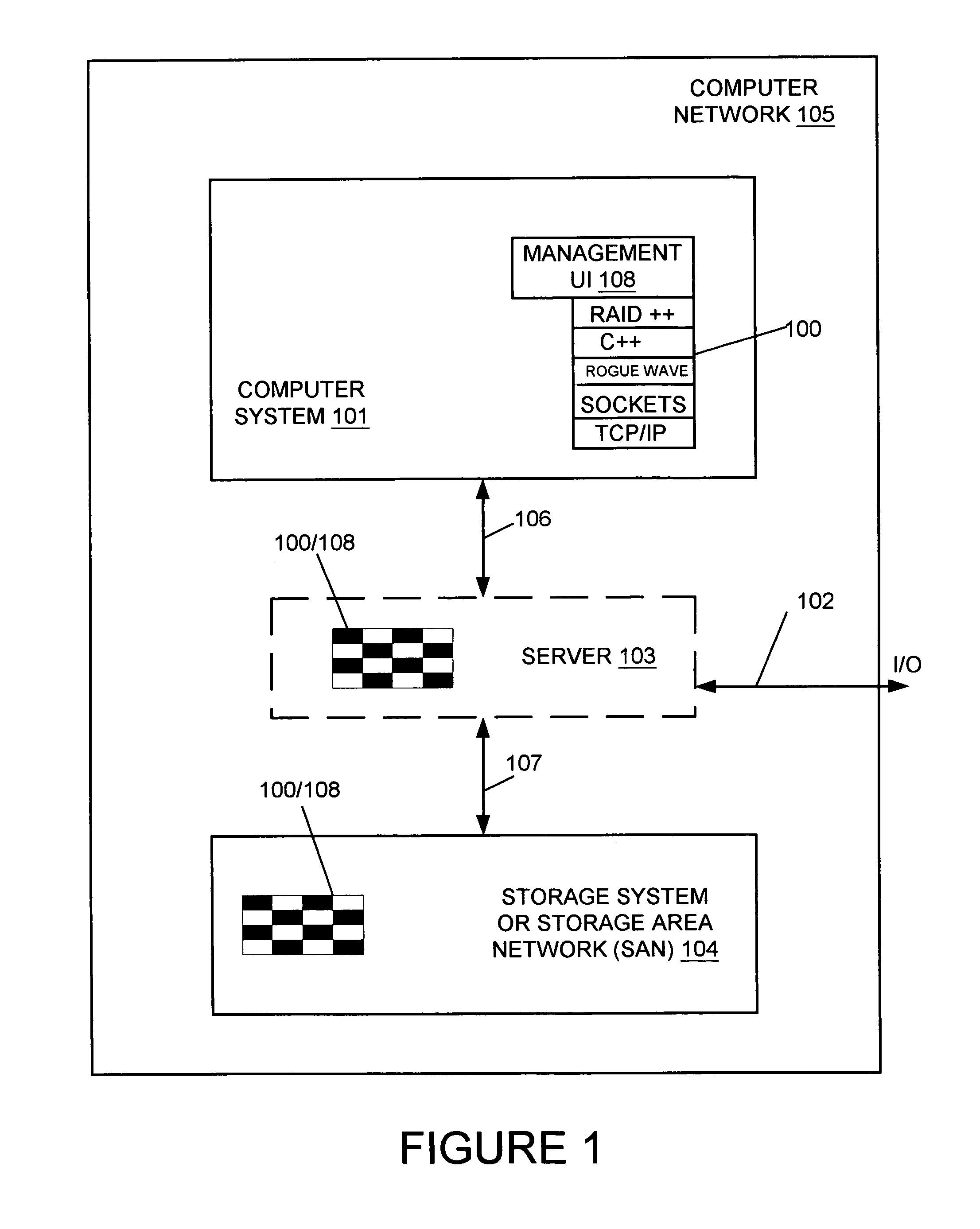

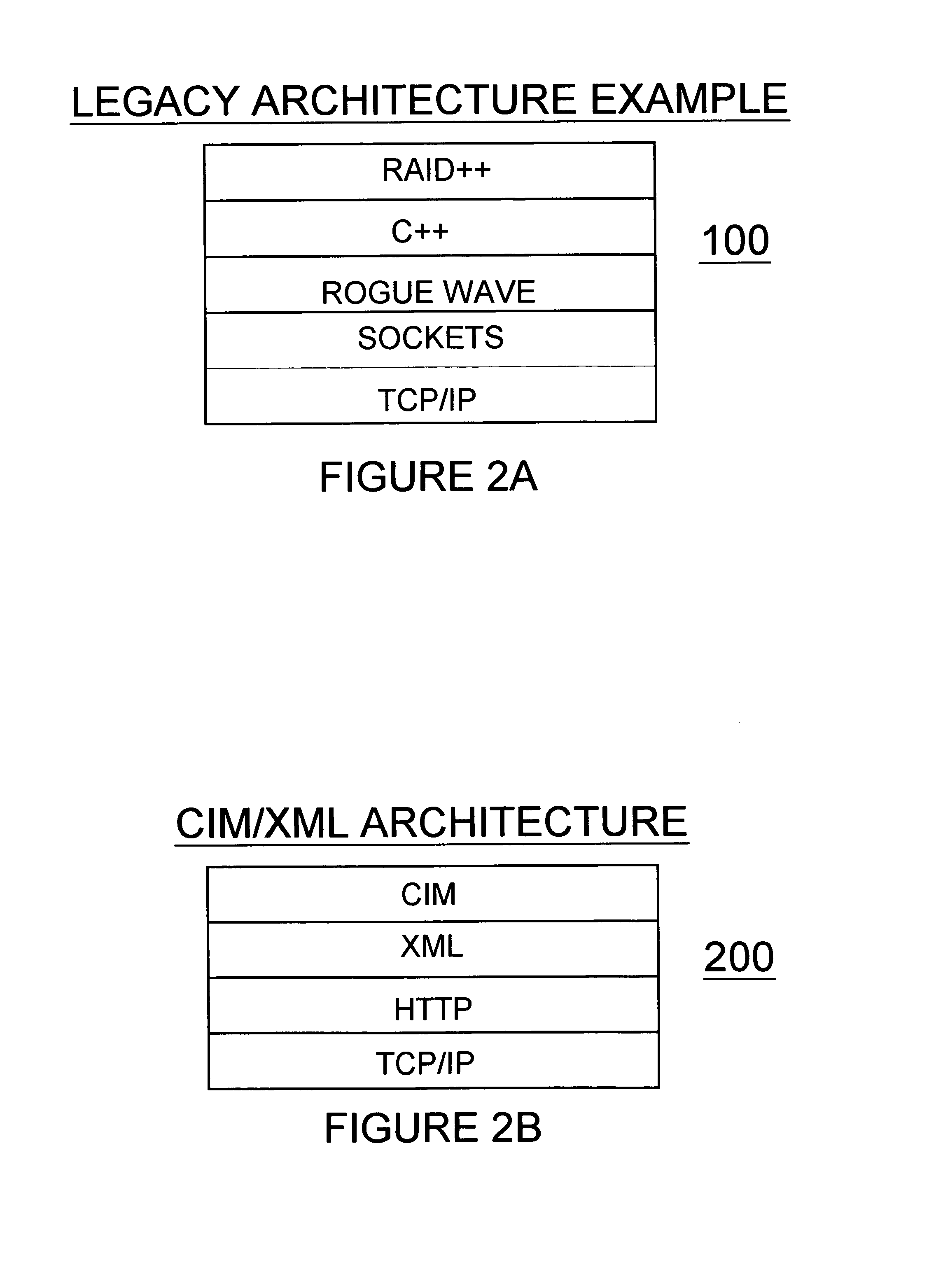

Translator-compiler for converting legacy management software

InactiveUS7406682B2Specific program execution arrangementsMemory systemsComputer compatibilitySchema for Object-Oriented XML

A translator-compiler for converting legacy architecture. In the area of management software or distributed management software, a standard architecture is evolving from legacy or proprietary architecture, and the standard embraces CIM / XML (Common Information Model / eXtensible Markup Language) computer language. Many vendors have developed proprietary languages for their respective management products that are incompatible with such standard. To accomplish compatibility between standard architecture and various different proprietary architectures, a substantial amount of code must be written at great effort and expense, unless an automatic, easily-applied and universal solution can be achieved. A translator-compiler is disclosed which meets these solution criteria and therefore solves this incompatibility problem. Flowcharts depicting algorithms along with sample input and output code in C++, as well as an example of the final XML result are also disclosed. Particular detail is disclosed with regard to storage management software aspects, although embodiments of the present invention are also operable with printer, server and other functional-component management software.

Owner:EMC IP HLDG CO LLC

Managing data in compliance with regulated privacy, security, and electronic transaction standards

InactiveUS7191463B2Preserving professional confidenceAvoid identificationMedical communicationData processing applicationsElectronic tradingConsent Type

Systems and methods for managing data in compliance with regulated privacy, security, and electronic transaction standards. One or more computer devices are used in a system to manage data in compliance with regulated privacy, security, and electronic transaction standards. In one implementation, a fax machine is used to provide a transmission set to a computer system, which acknowledges receipt of the set and preserves the transmission set for a period of time to satisfy a regulation. The system includes a single point of entry for external and / or internal requests, and / or a single point of exit for transmissions of information, wherein the transmissions include individually identifiable patient information to legitimate patient-approved requests. Information is de-identified so as to be selectively used and / or sold. The de-identification prevents the identification of patients corresponding to the medical information, thus allowing the information to be useful while still preserving professional confidences. Moreover, digital authorizations and consents for retrieval from external data sources may be utilized.

Owner:VERISMA SYST

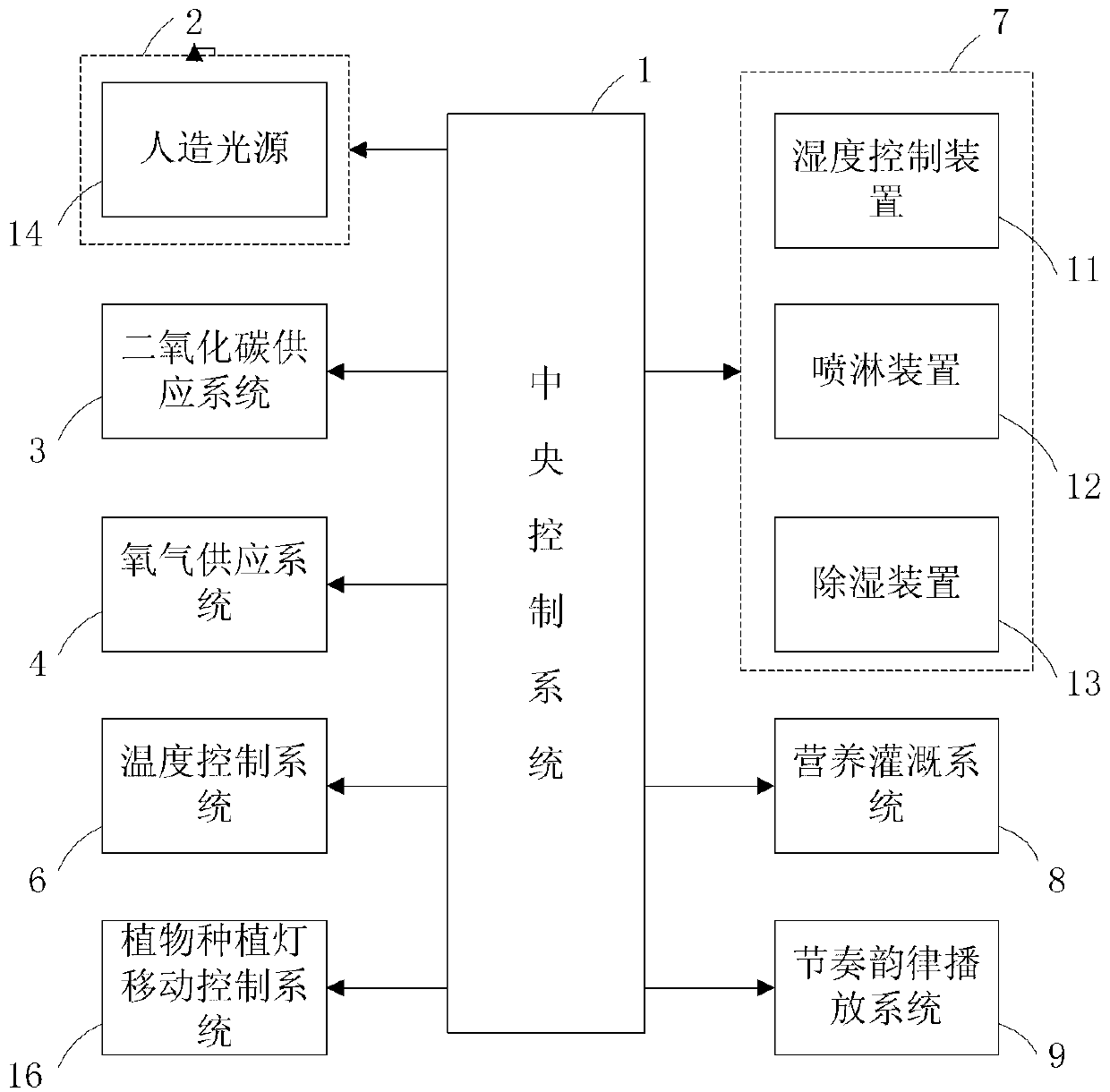

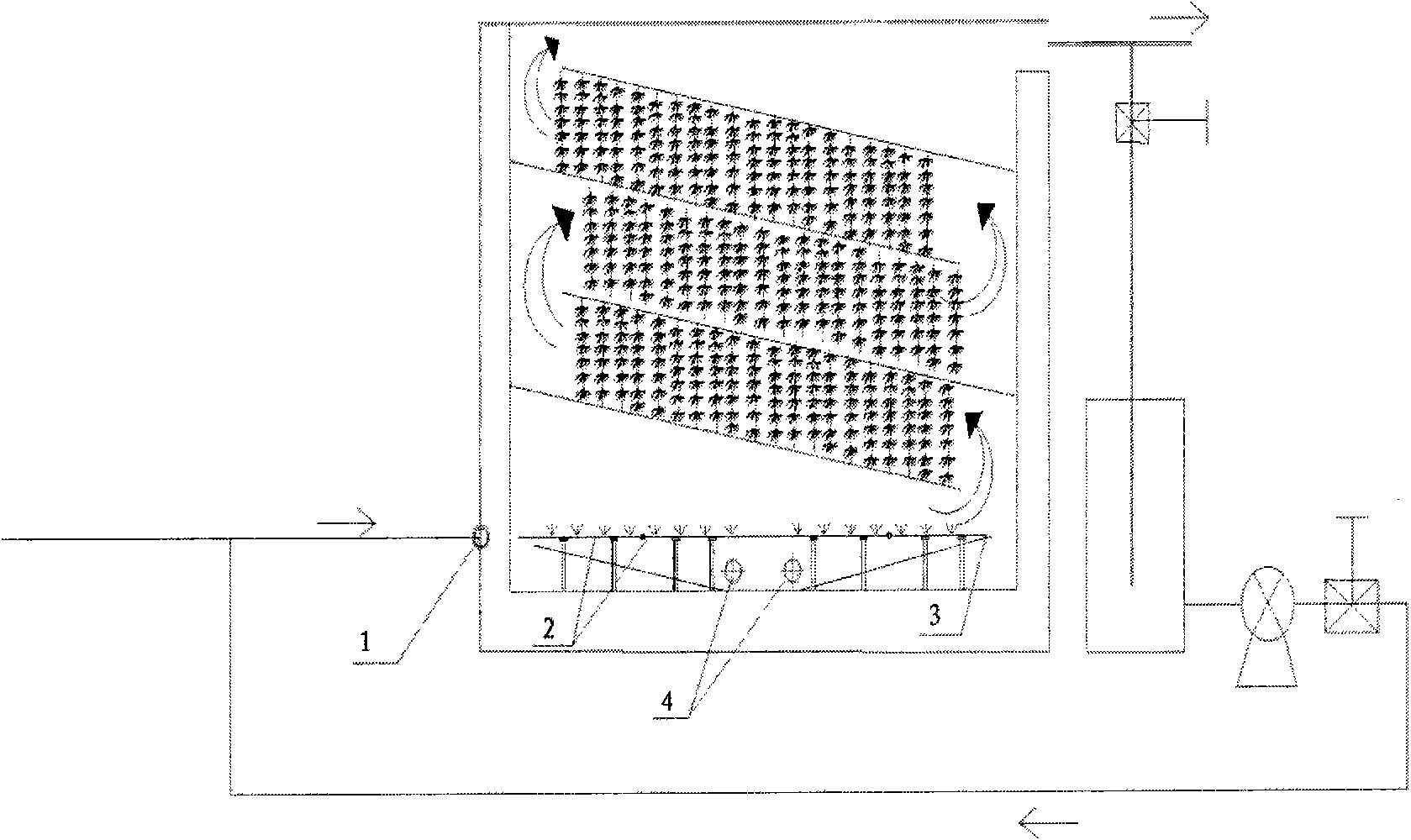

System and method of planting of plant based on standard environment

InactiveCN103098665AImprove vividnessShorten seedling timeClimate change adaptationGreenhouse cultivationLight energyPlant growth

The invention discloses a system of planting of a plant based on a standard environment. The system of planting of the plant based on the standard system comprises at least one planting area, a central controlling system and at least one sub-control system, wherein the planting area is independent of outside and uses artificial light as the only or main light source. The sub-control system comprises an artificial light source control system, a carbon oxide supply system, an oxygen supply system, a temperature control system, a humidity control system, a nutrition irrigation system and a rhythm broadcast system. The invention further discloses a method of planting of the plant based on the standard environment. The system and the method of planting of the plant based on the standard environment create ideal environment for growth of a plant, through scientific and accurate control of plant external factor under the condition of the best planting conditions and stable sufficient light energy, according to photosynthetic requirements of different plants, build up an illumination circle of day and night of 6 to 23 hours, enable time utilization rate of the photosynthesis to be more than 90%, greatly increase yield and quality, and free of pesticide implementation and are green and environmental-protecting.

Owner:鲜语智慧(广州)农业科技有限公司

Method, apparatus, and computer program product in a processor for performing in-memory tracing using existing communication paths

A method, apparatus, and computer program product are disclosed for performing in-memory hardware tracing in a processor using an existing system bus. The processor includes multiple processing units that are coupled together utilizing the system bus. The processing units include a memory controller that controls a system memory. Information is transmitted among the processing units utilizing the system bus. The information is formatted according to a standard system bus protocol. Hardware trace data is captured utilizing a hardware trace facility that is coupled directly to the system bus. The system bus is utilized for transmitting the hardware trace data to the memory controller for storage in the system memory. The memory controller is coupled directly to the system bus. The hardware trace data is formatted according to the standard system bus protocol for transmission via the system bus.

Owner:IBM CORP

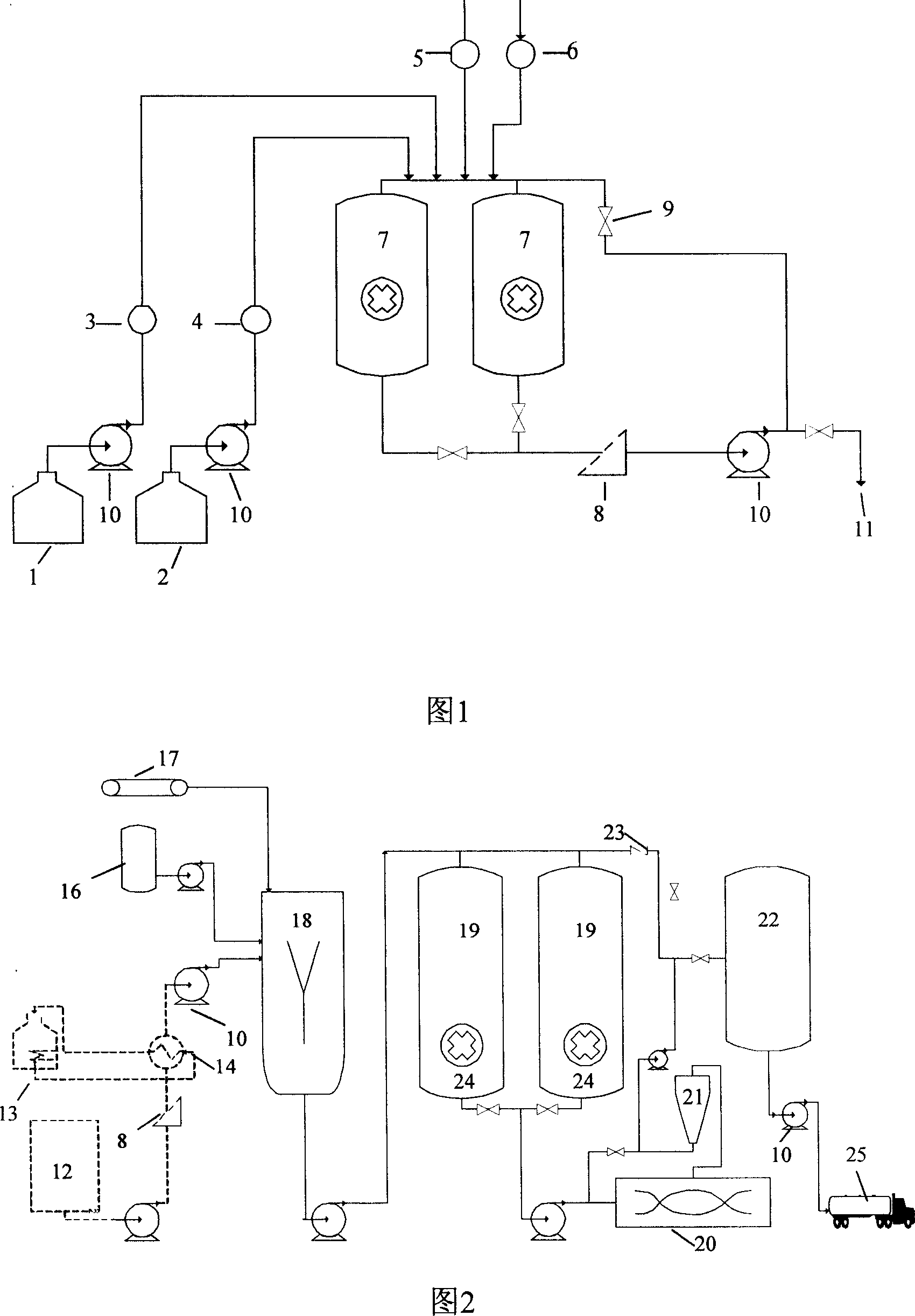

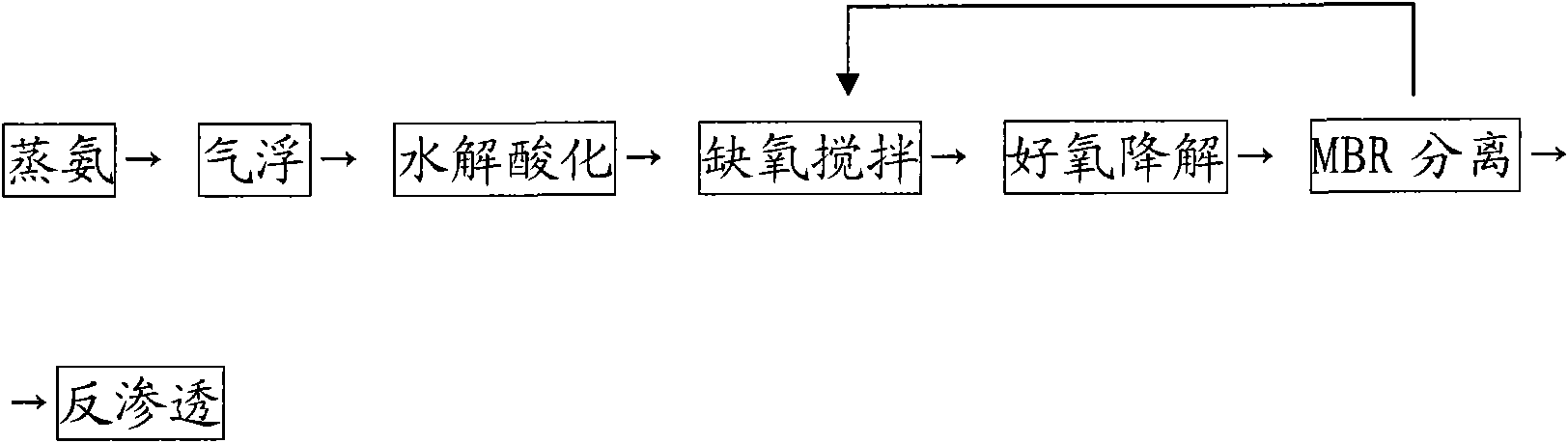

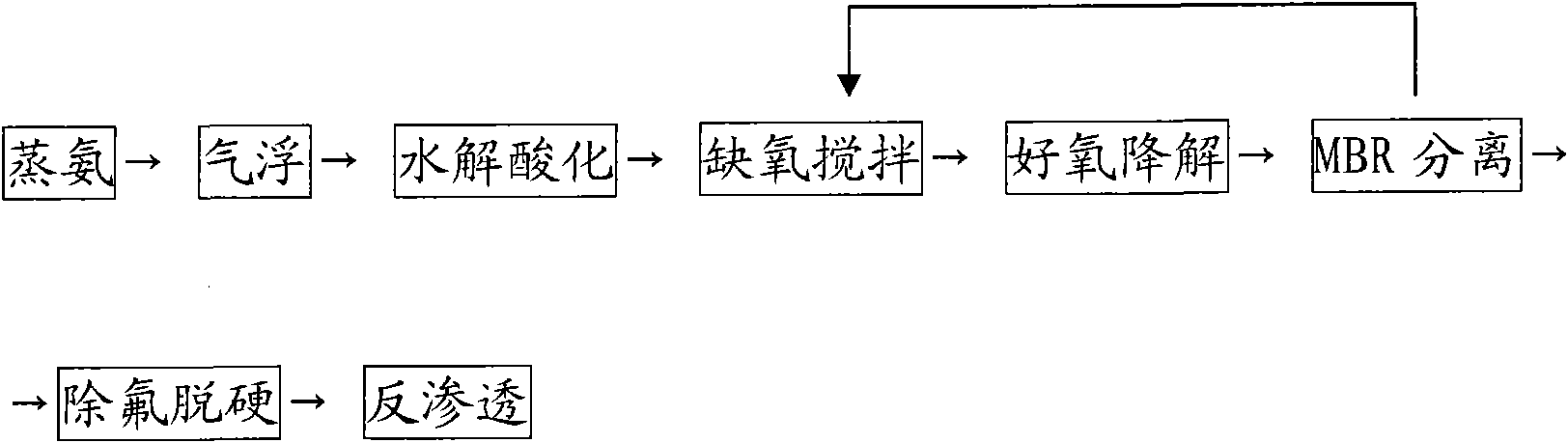

Comprehensive treatment process for coking wastewater

InactiveCN101817617ARemove completelyReduce COD contentTreatment with aerobic and anaerobic processesWater/sewage treatment bu osmosis/dialysisReverse osmosisEvaporation

The invention relates to a comprehensive treatment process for coking wastewater, which belongs to the technical field of water treatment and solves the problem that the treatment of the coking wastewater in the prior art is not thorough and the produced water cannot be repeatedly used as water for production. The process comprises the following several steps: ammonia evaporation, air flotation, hydrolysis acidification, anoxic stirring, aerobic degradation, MBR separation and reverse osmosis. The process is applicable to reformation of wastewater treatment and drainage off-standard systems in various coal chemical industries, wastewater source utilization in the coal coking industry and application of wastewater closed internal cycle zero-release engineering in the coal coking industry.

Owner:广州泰通环保科技投资有限公司

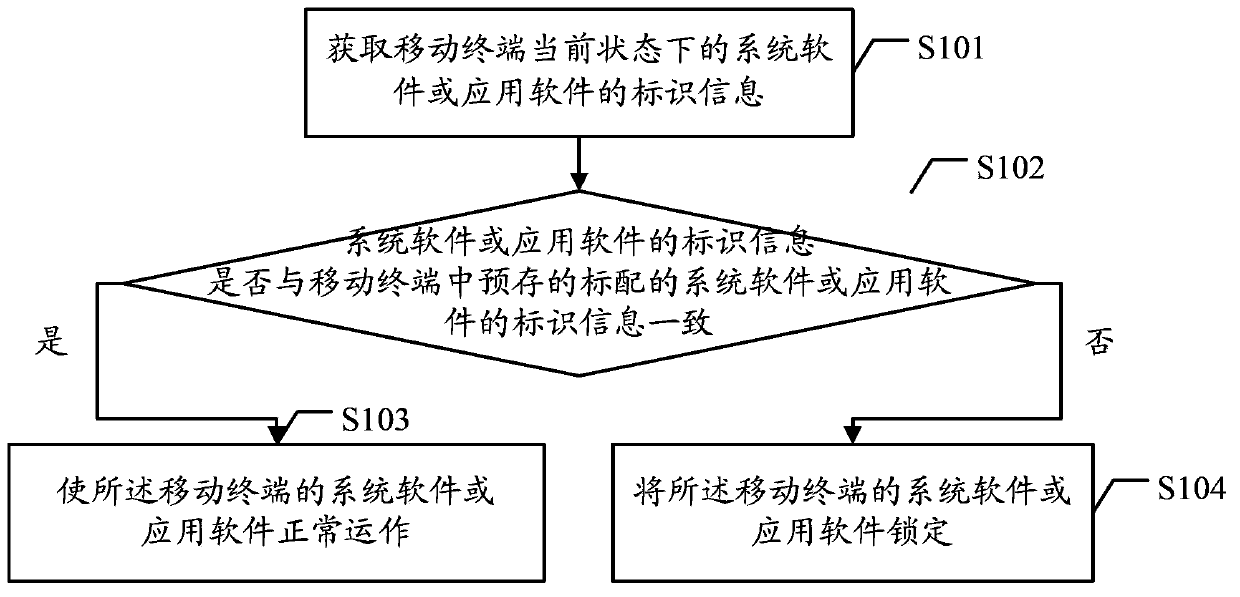

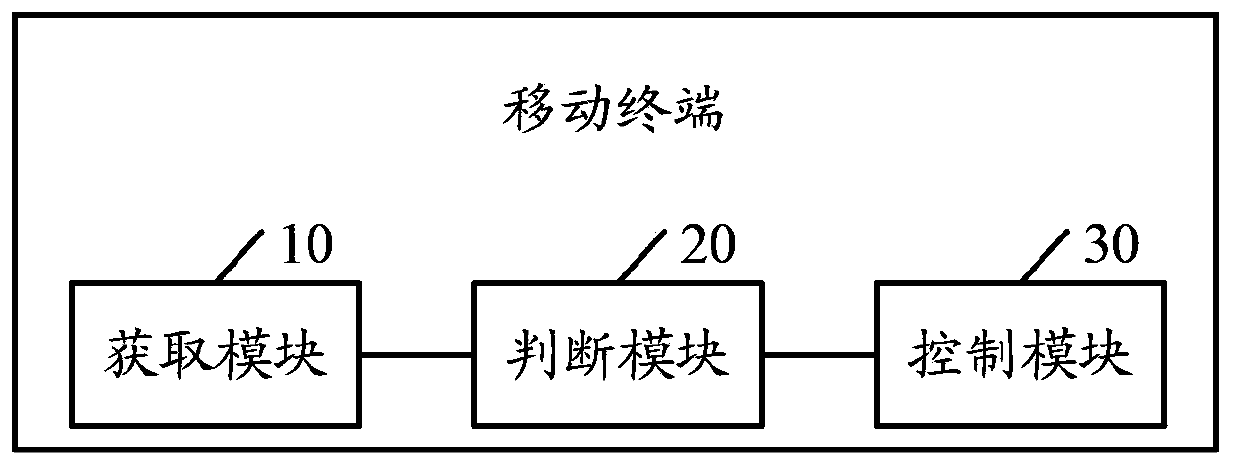

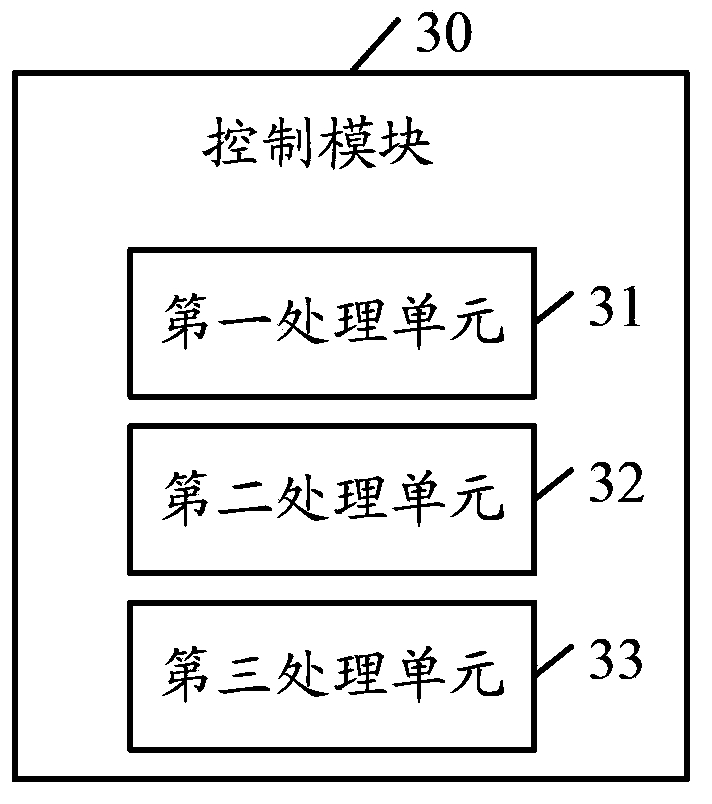

Method for managing mobile terminal software and mobile terminal

InactiveCN103389898AAvoid erratic or even severe crashesAvoid deletionSpecific program execution arrangementsInstabilitySoftware engineering

The embodiment of the invention discloses a method for managing mobile terminal software, which includes the following steps: the identification information of the system software or application software of a mobile terminal under the current state is acquired; whether the identification information of the system software or application software is the same as the identification information of standard system software or application software prestored in the mobile terminal is judged; if a judgment result is yes, then the system software or application software of the mobile terminal is enabled to normally operate, and if the judgment result is no, then the system software or application software of the mobile terminal is locked. The embodiment of the invention also discloses a mobile terminal. The method and the mobile terminal have the advantage that the unauthorized reinstallation of the mobile terminal by a user can be limited, so that the instability of the operation of the mobile terminal as the result of unauthorized reinstallation by the user is prevented, and thereby the stability of the operation of the mobile terminal is guaranteed.

Owner:SHENZHEN GIONEE COMM EQUIP

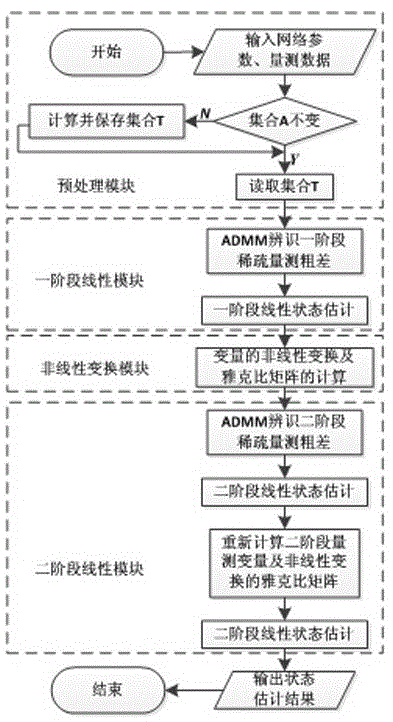

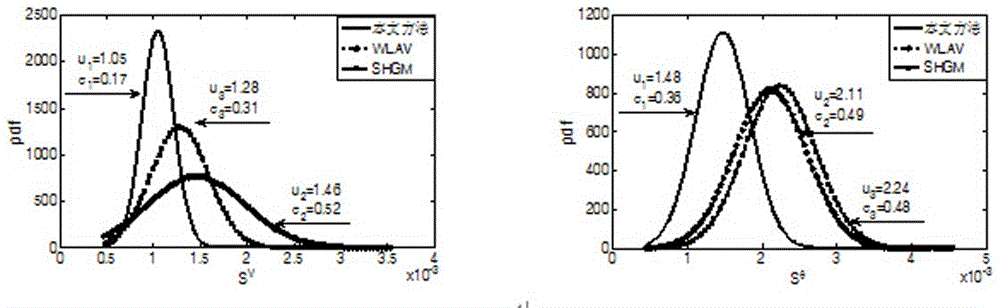

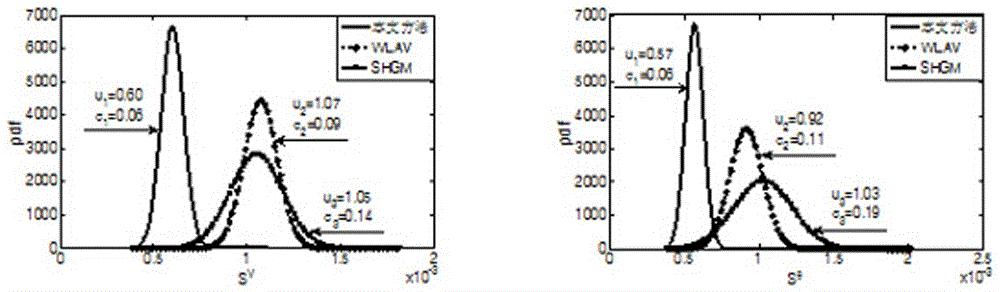

Electric power system bilinear anti-error estimation method based on bilinear protruding optimization theory

The present invention discloses an electric power system bilinear anti-error estimation method based on a bilinear protruding optimization theory. A bilinear theory is introduced, and a non-linear measurement equation is converted to a two-phase linearity measurement equation; the sparse characteristic of the rough error is calculated and measured, the anti-error estimation is converted to the two-phase strict protruding optimization problem; and each phase identifies the sparse measurement rough error based on the ADMM, rejects the rough error in the measurement to employ the WLS for solution, and maintains the WLS advantages. The test results of the IEEE standard system and the national real power grid show that: because the bilinear theory is introduced, the calculation efficiency of the electric power system bilinear anti-error estimation method is higher than that of a traditional WLS estimator, the ADMM technology greatly identifies the spare measurement rough error to allow the estimation precision of the electric power system bilinear anti-error estimation method to be better than that of a traditional anti-error estimator.

Owner:STATE GRID CORP OF CHINA +4

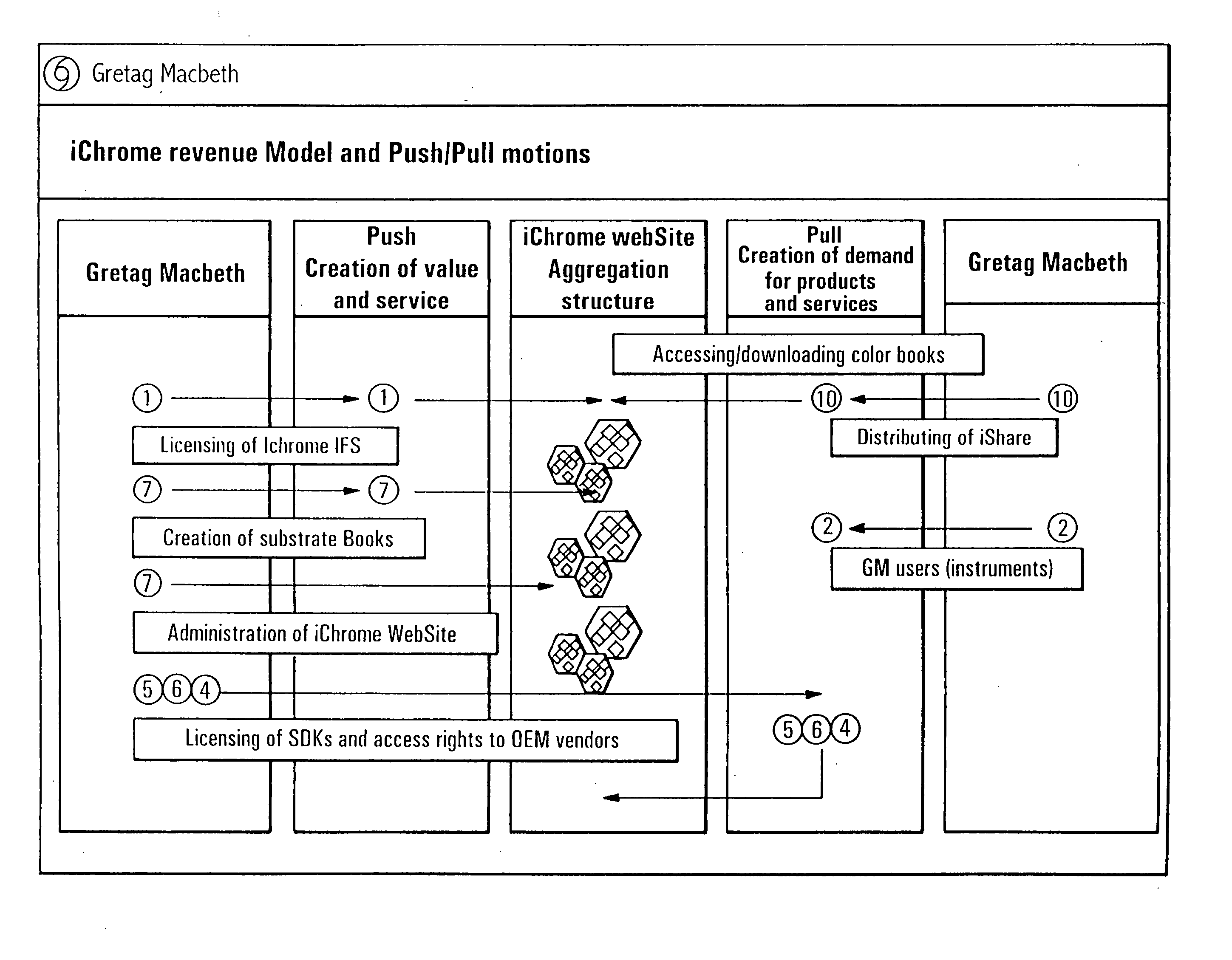

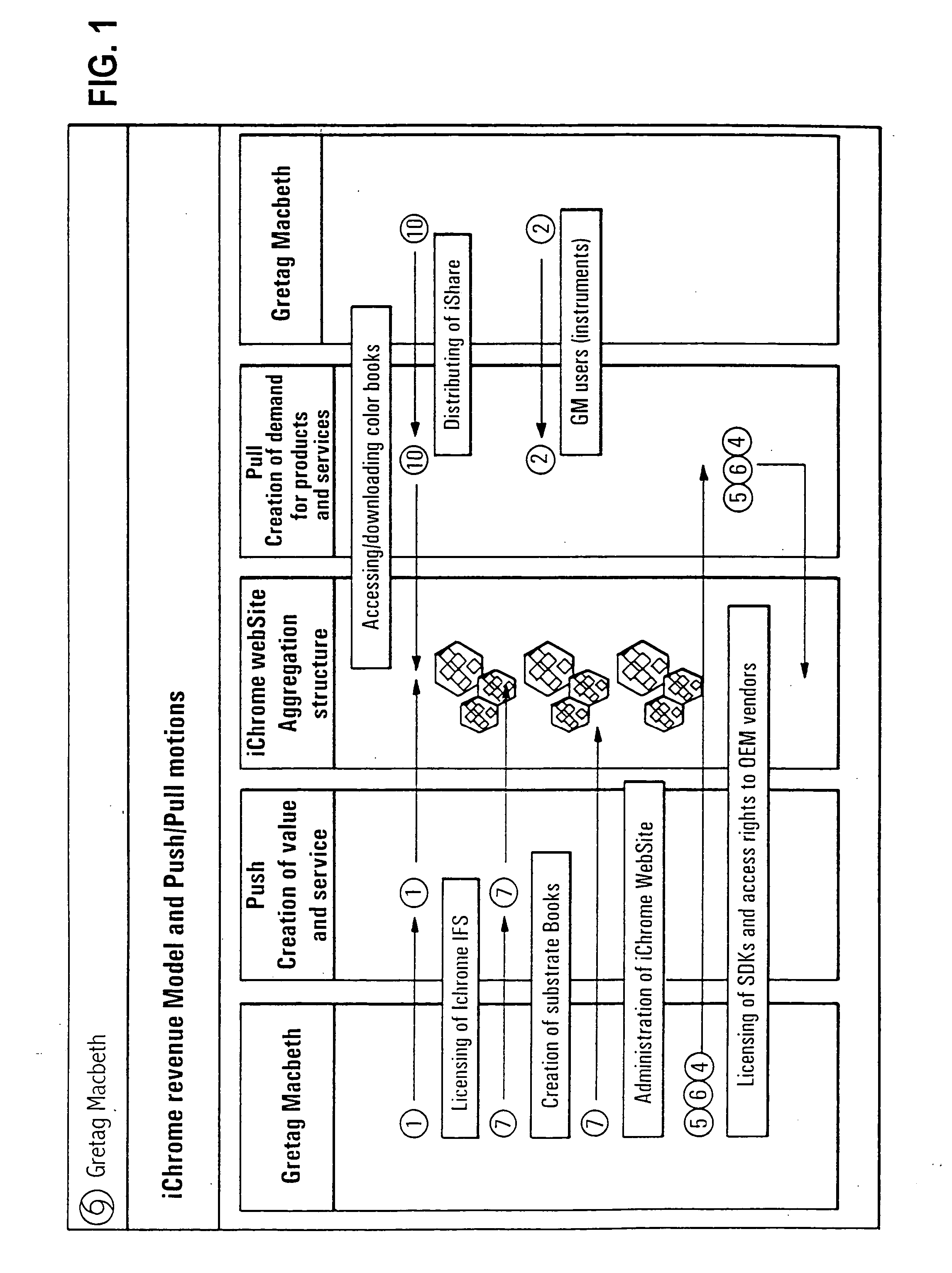

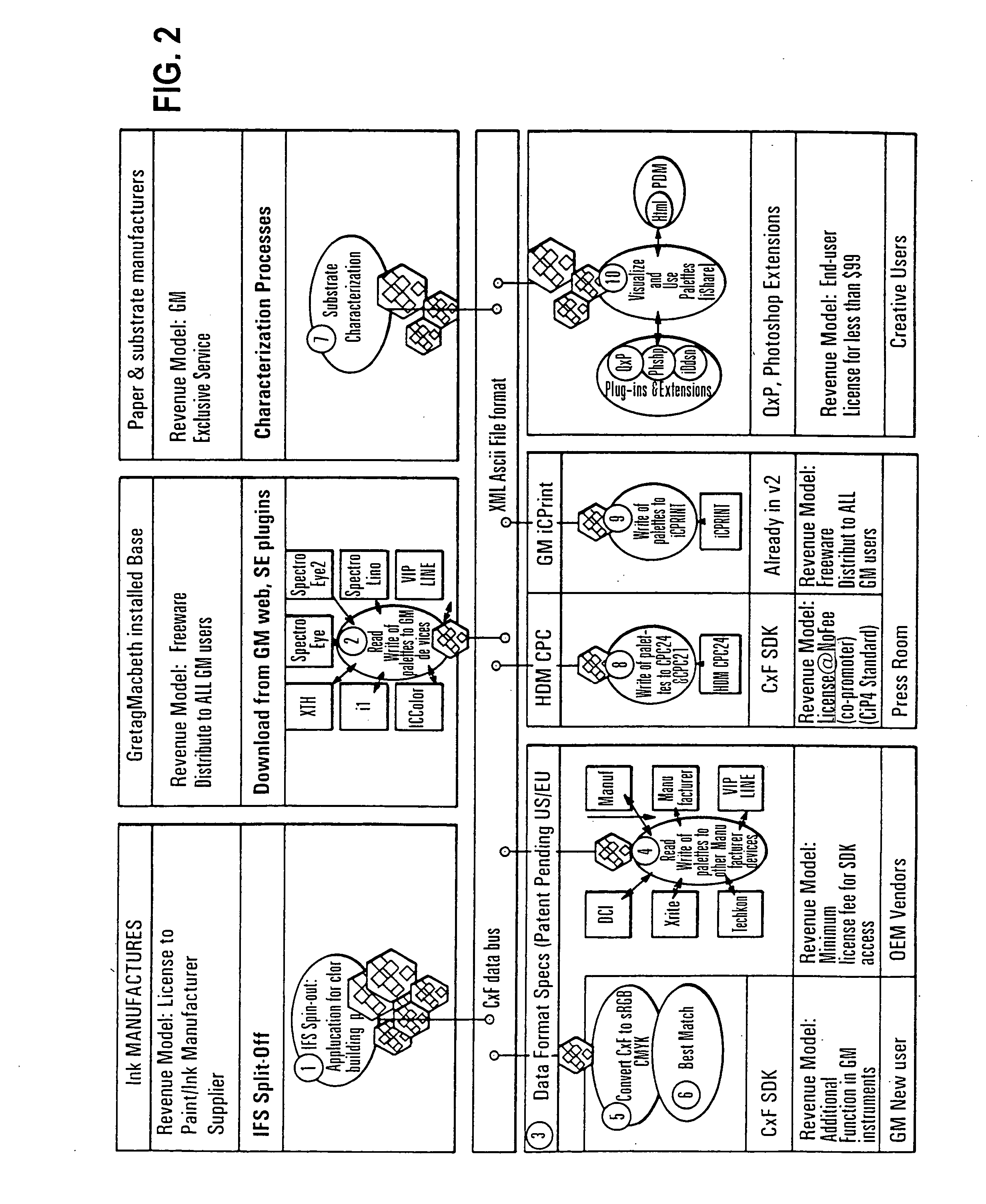

Digital color standard

InactiveUS20040145758A1Overcomes shortcomingEasy to useDigitally marking record carriersDigital computer detailsComputer scienceStandard system

A method for generating a digital color standard system for the generation and reproduction of standardized colors is provided, wherein a color spectrum is divided into a plurality of discrete spectral color values with predetermined gaps and the discrete spectral color values are digitized in order to be processed in accordance with the color standard. A computer system for for generating a digital color standard system for the generation or reproduction of standardized colors is also provided. The computer system includes a processor that is programmed to (i) divide a color spectrum into a plurality of discrete spectral color values with predetermined gaps between at least some of the discrete spectral color values, (ii) digitize the discrete spectral color values; and (iii) process the digitized color values. A data carrier is also providing for receiving color data that may be generated according to the foregoing method and / or using the foregoing computer system.

Owner:GRETAGMACBETH LLC

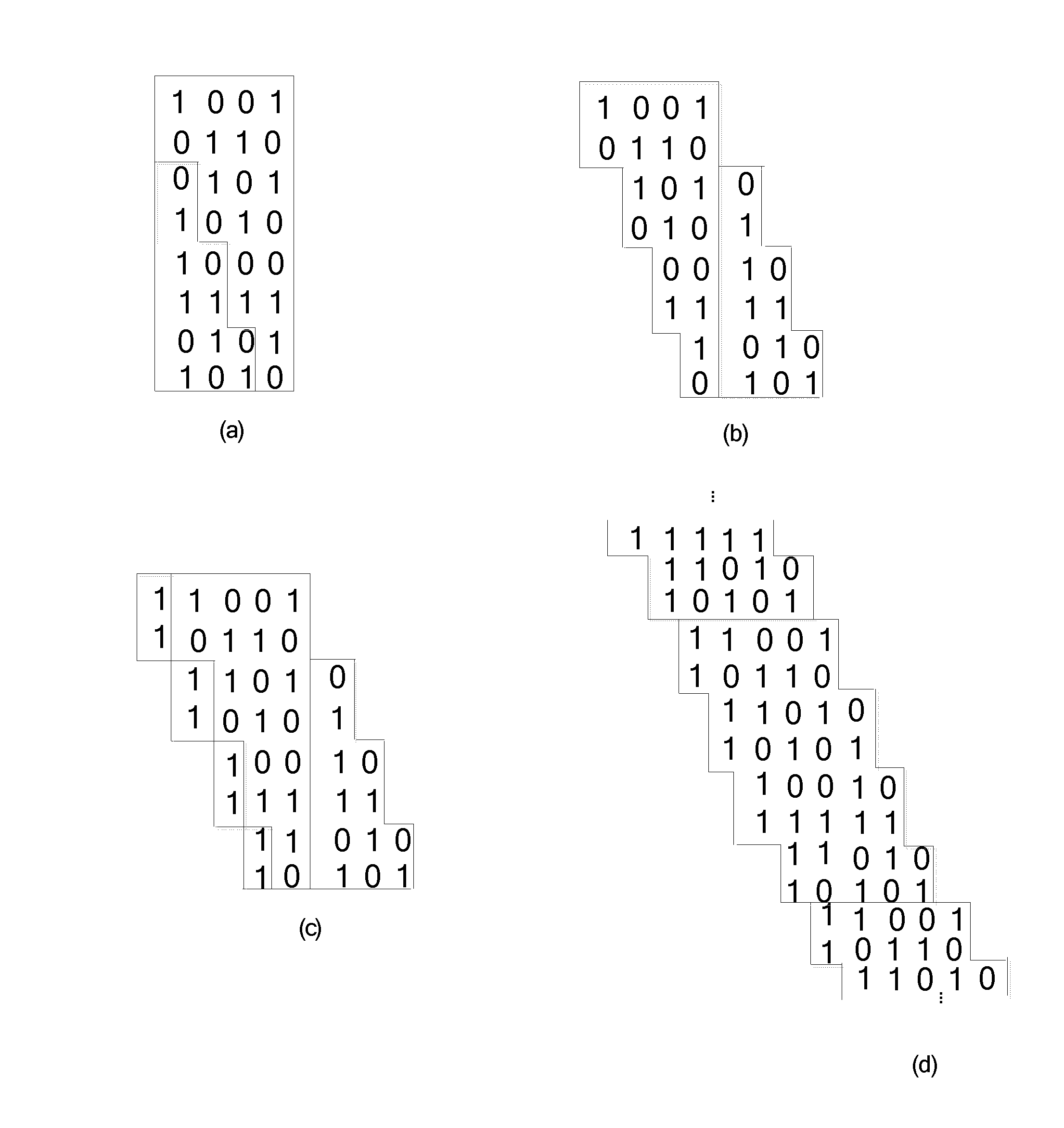

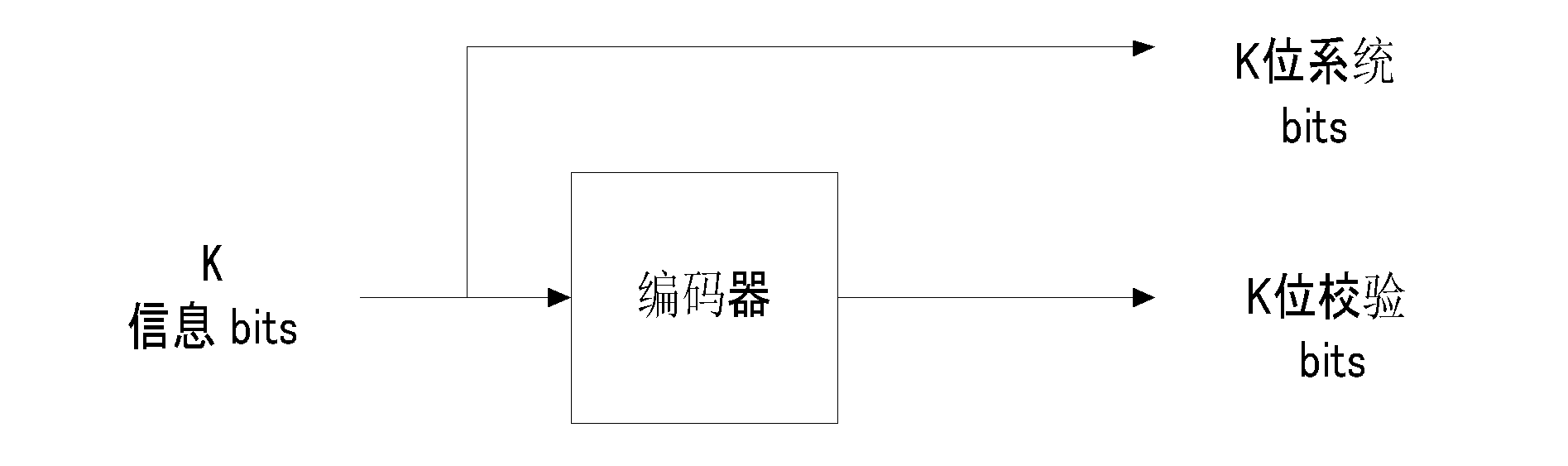

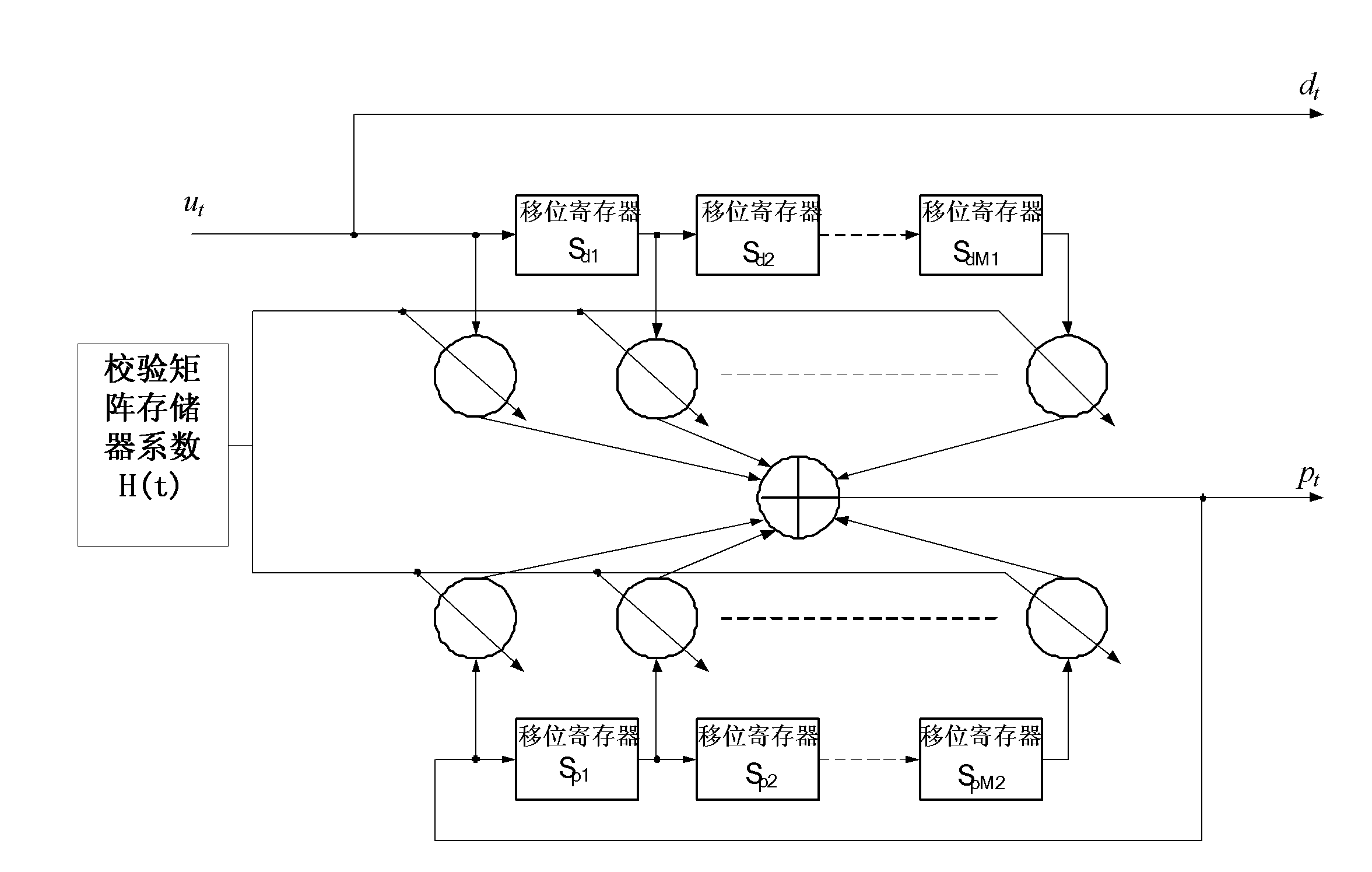

Method for improving structure of convolution code encoder

InactiveCN102437858AReduce coding complexityEase of hardware implementationError correction/detection using convolutional codesLdpc convolutional codesFrequency spectrum

The invention relates to a method for improving a structure of a convolution code encoder, particularly relates to a method which is applied to wireless local area network (WLAN) and long time evolution (LTE) relevant standard systems and used for improving the structure of the convolution code encoder, and belongs to the technical field of wireless mobile communication. By designing parameters of the encoder for a low density parity check (LDPC) convolution code and a check matrix H (t) of the LDPC convolution code and improving the encoding structure of the convolution code, the high performance and low error rate are realized. The LDPC convolution code integrates the advantages of both an LDPC code and the convolution code; due to the regular structure, the convolution code encoder has high-speed encoding capability; and the hardware of the encoder is simplified; the encoding complexity of the LDPC convolution code is reduced, and the parallel iterative decoding can be performed to realize low time delay; under the condition of rate compatibility, during forward error correction control (FEC) of IEEE 802.16m, the LDPC convolution code be used for realizing hybrid automatic repeat request (HARQ) which supports an IR type; therefore, the spectrum efficiency and the system throughput are improved.

Owner:BEIJING INSTITUTE OF TECHNOLOGYGY

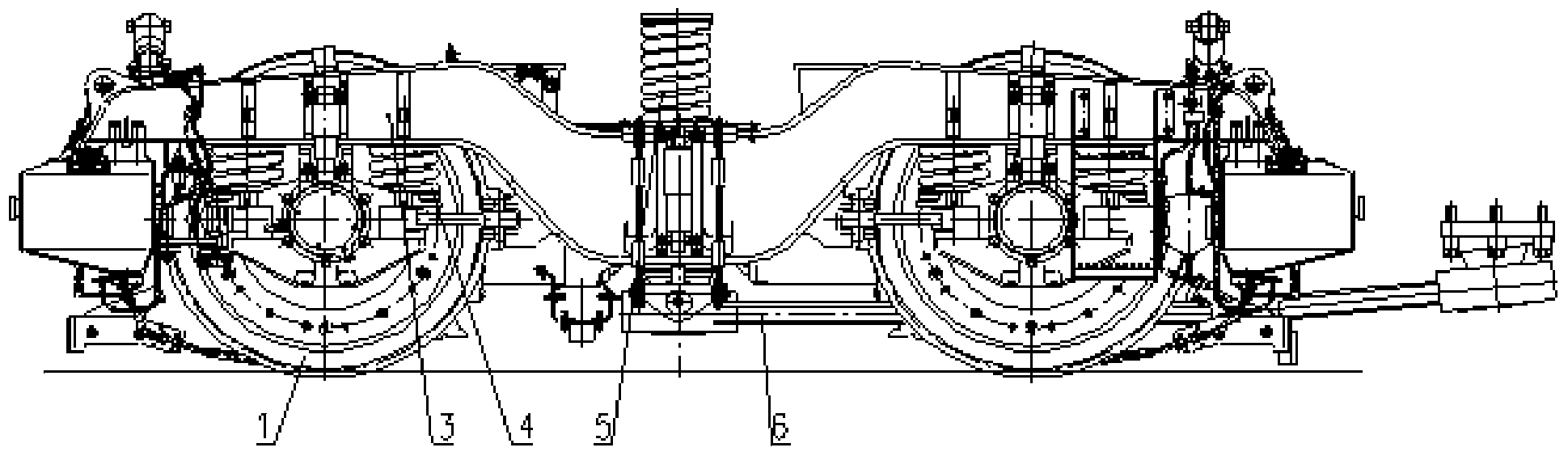

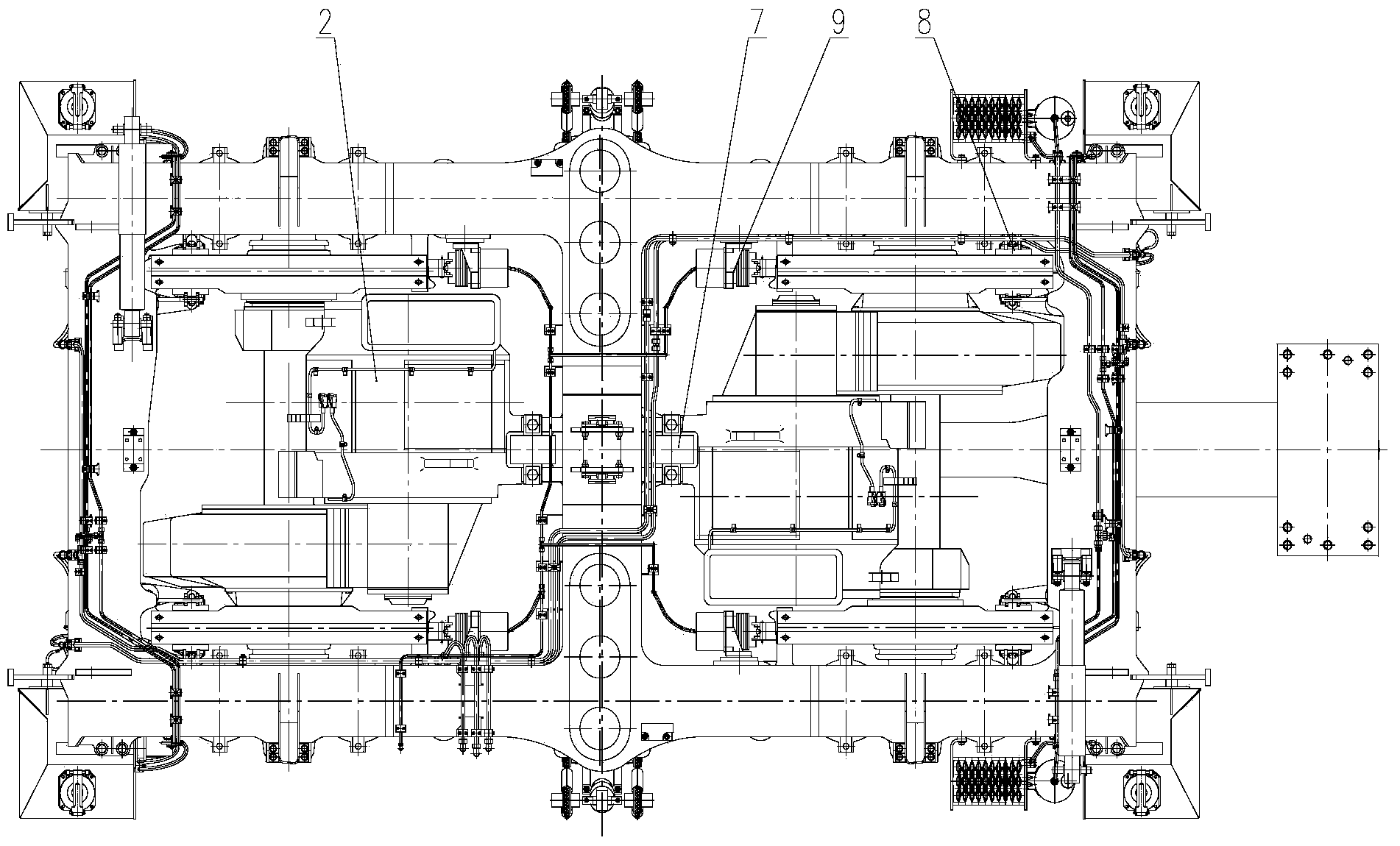

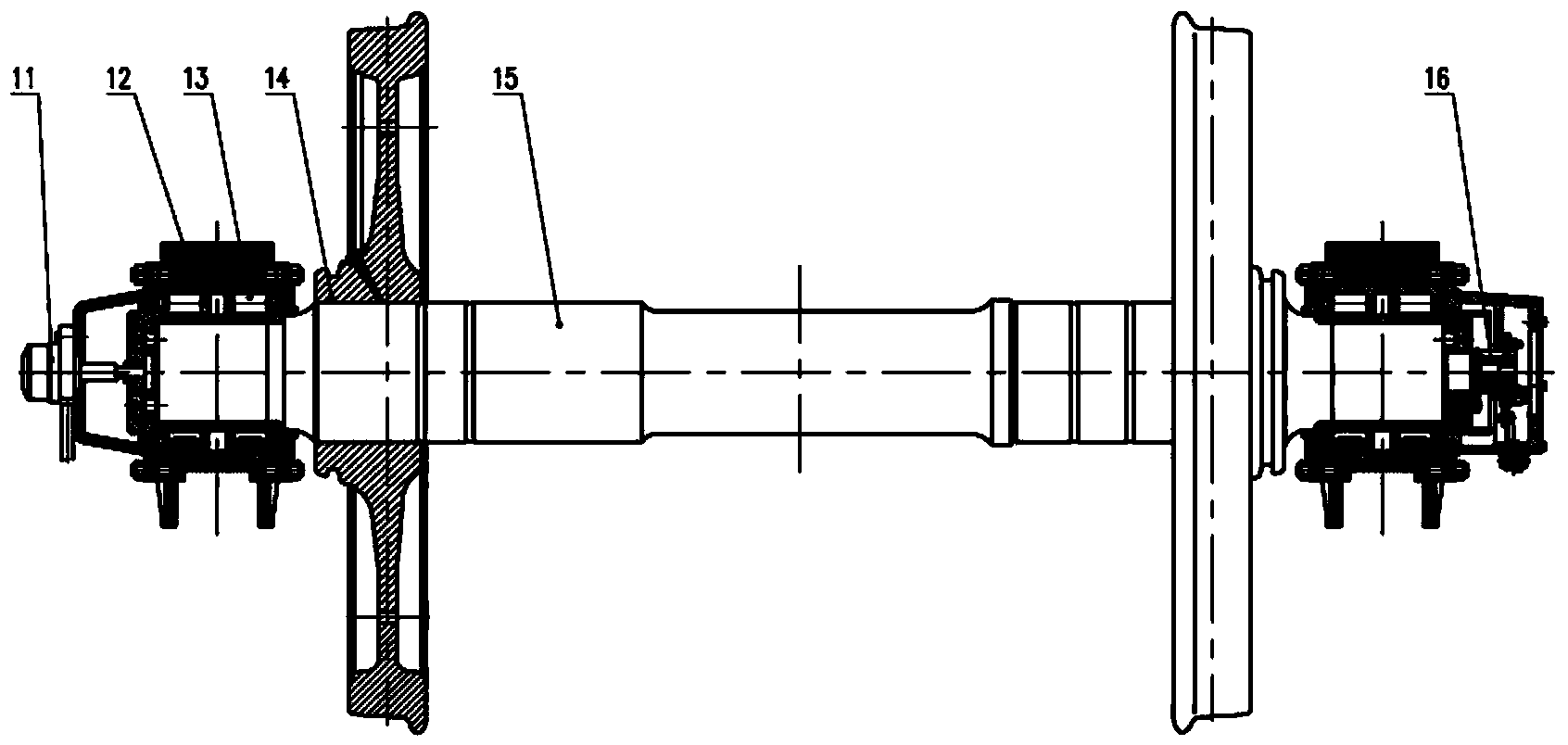

Two-axle bogie of electric locomotive with 30-ton axle weight

InactiveCN103625498AIncrease capacityOptimize lateral dynamicsAxle-boxes mountingBogieCarrying capacity

The invention discloses a two-axle bogie of an electric locomotive with the 30-ton axle weight. The two-axle bogie is of a two-axle structure and is mainly composed of two wheel set axle box assemblies, two driving units, a framework, four primary suspension devices, a secondary suspension device, a traction device, two motor suspension devices, two braking devices and four tread cleaning devices. According to the improved design of the bogie, the reasonable traction mode and the best suspension parameter configuration are adopted, the heavy-load locomotive can achieve the best adhesion utilization rate and have the good curve negotiating performance, the reliable requirement is met, the power capacity and the traction capacity of the locomotive are developed to the greatest extent, the comprehensive performance of the locomotive is optimized, the running safety, smoothness and comfort indexes are good, the two-axle bogie can be used for greatly improving the carrying capacity of a railway, a research and development platform for the bogie of the electric freight locomotive with the large axle weight, a relevant test system and a relevant standard system are built, and the technical gap for the electric locomotive with the large axle weight is filled in.

Owner:CHINA RAILWAYS CORPORATION +1

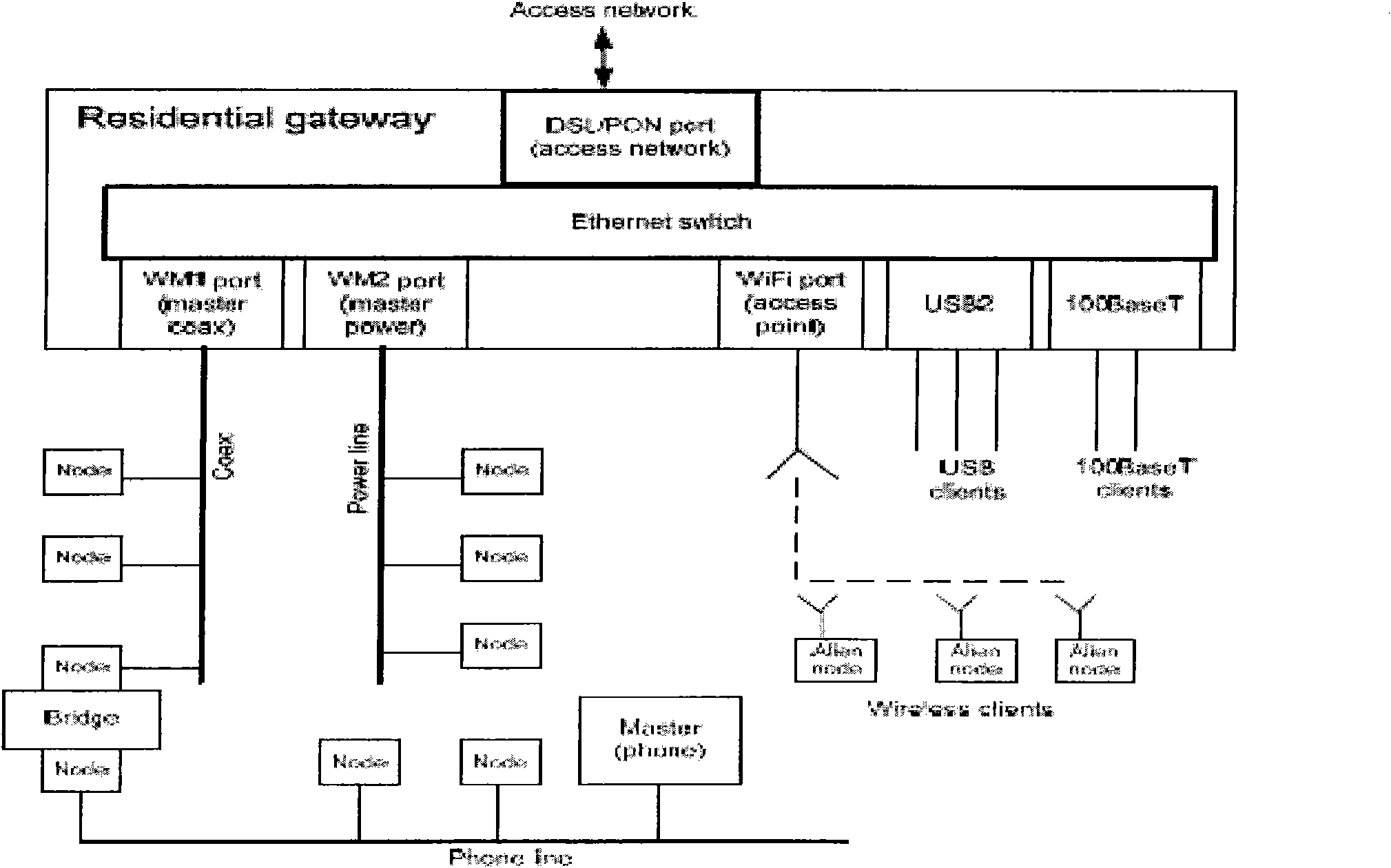

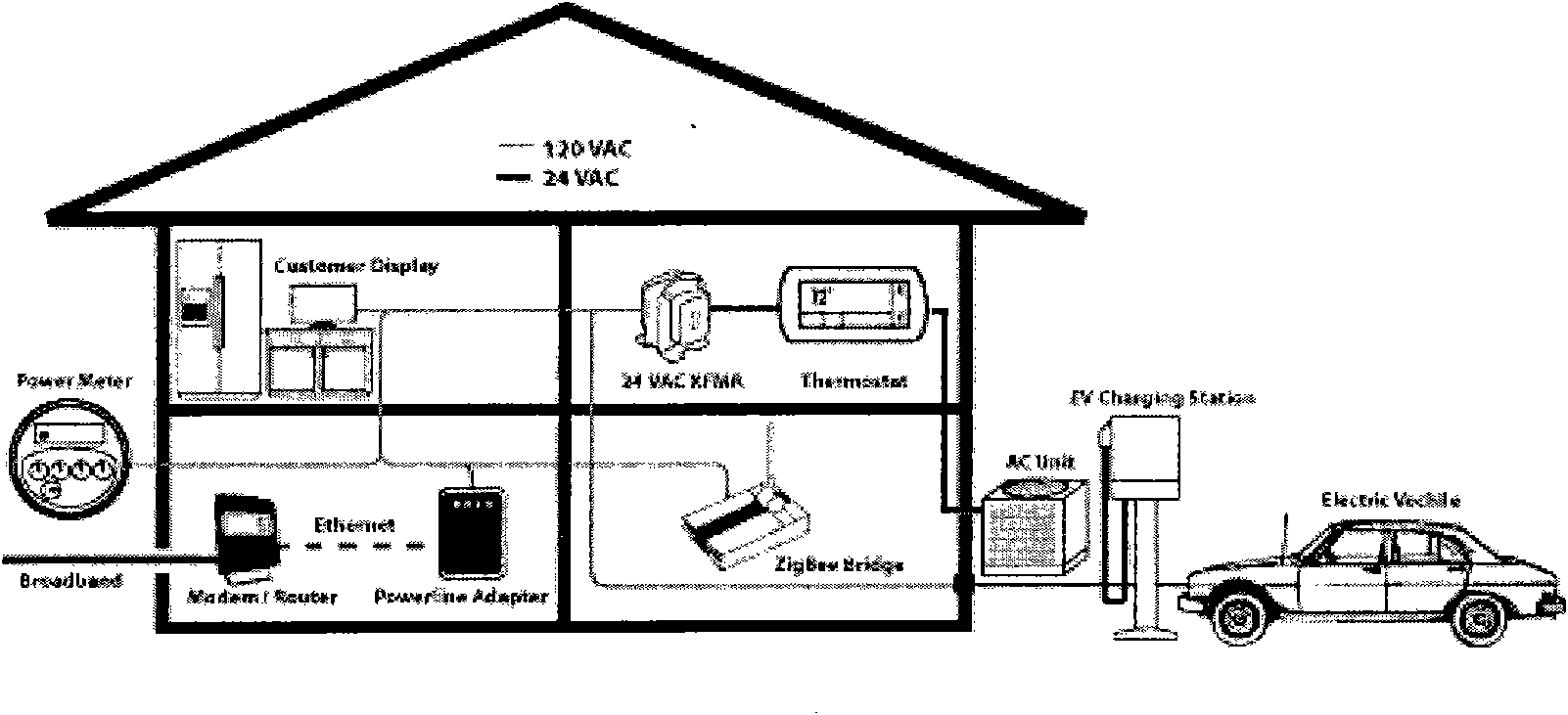

Method, system and device for realizing bidirectional communication by combining passive optical network with power-line carrier

InactiveCN101945309AEasy to handleLow costMultiplex system selection arrangementsPower distribution line transmissionProtocol processingCarrier signal

The invention relates to a method, a system and a device for realizing communication between a terminal node and a central control node by combining a passive optical network with power-line carrier. The invention simplifies gateway protocol processing levels, thereby lowering the gateway cost and power consumption and enhancing the gateway reliability and safety. The invention can enable the system to have wide compatibility with different power-line carrier standard systems.

Owner:李淑英

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com