Patents

Literature

140results about How to "Improve" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

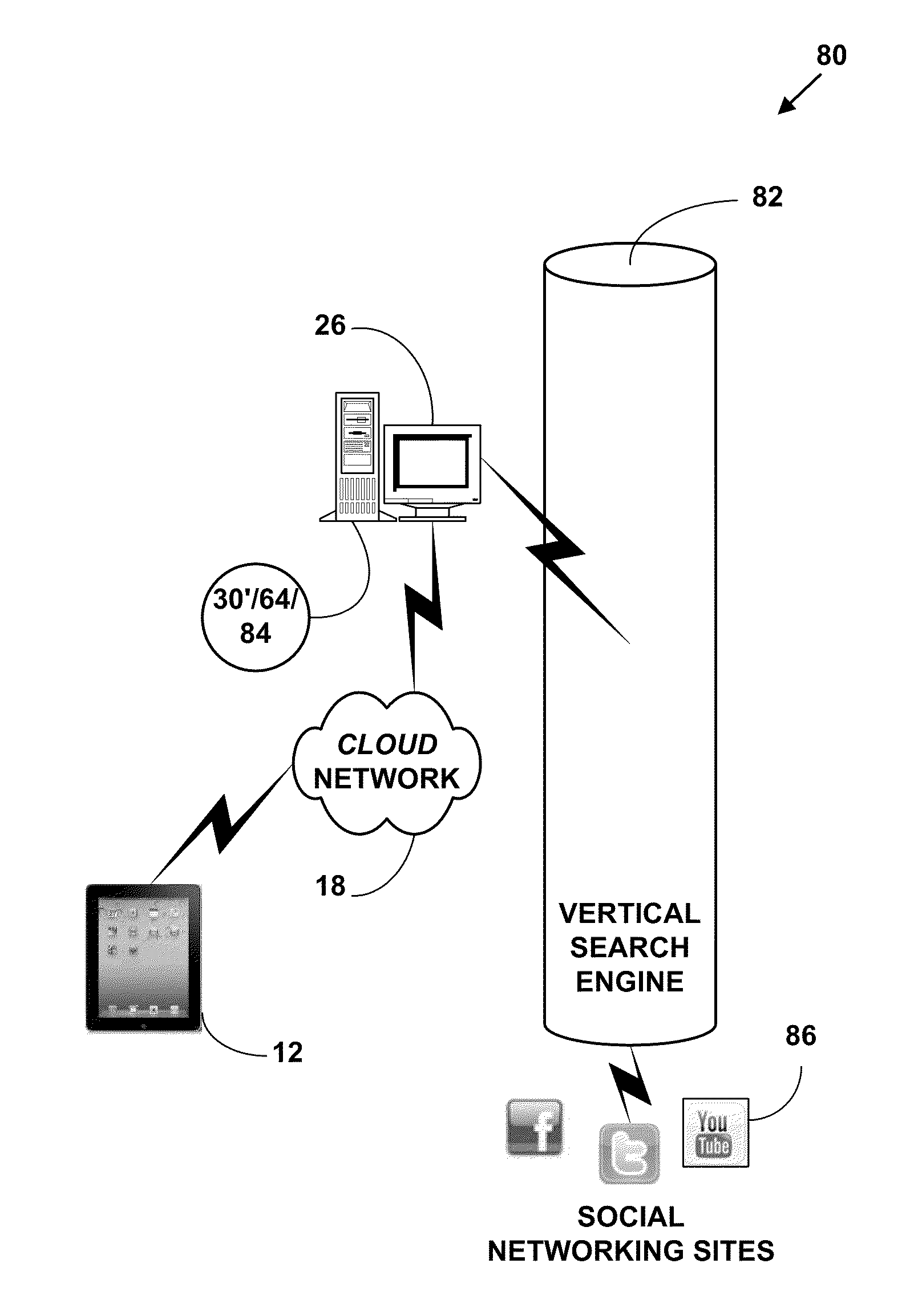

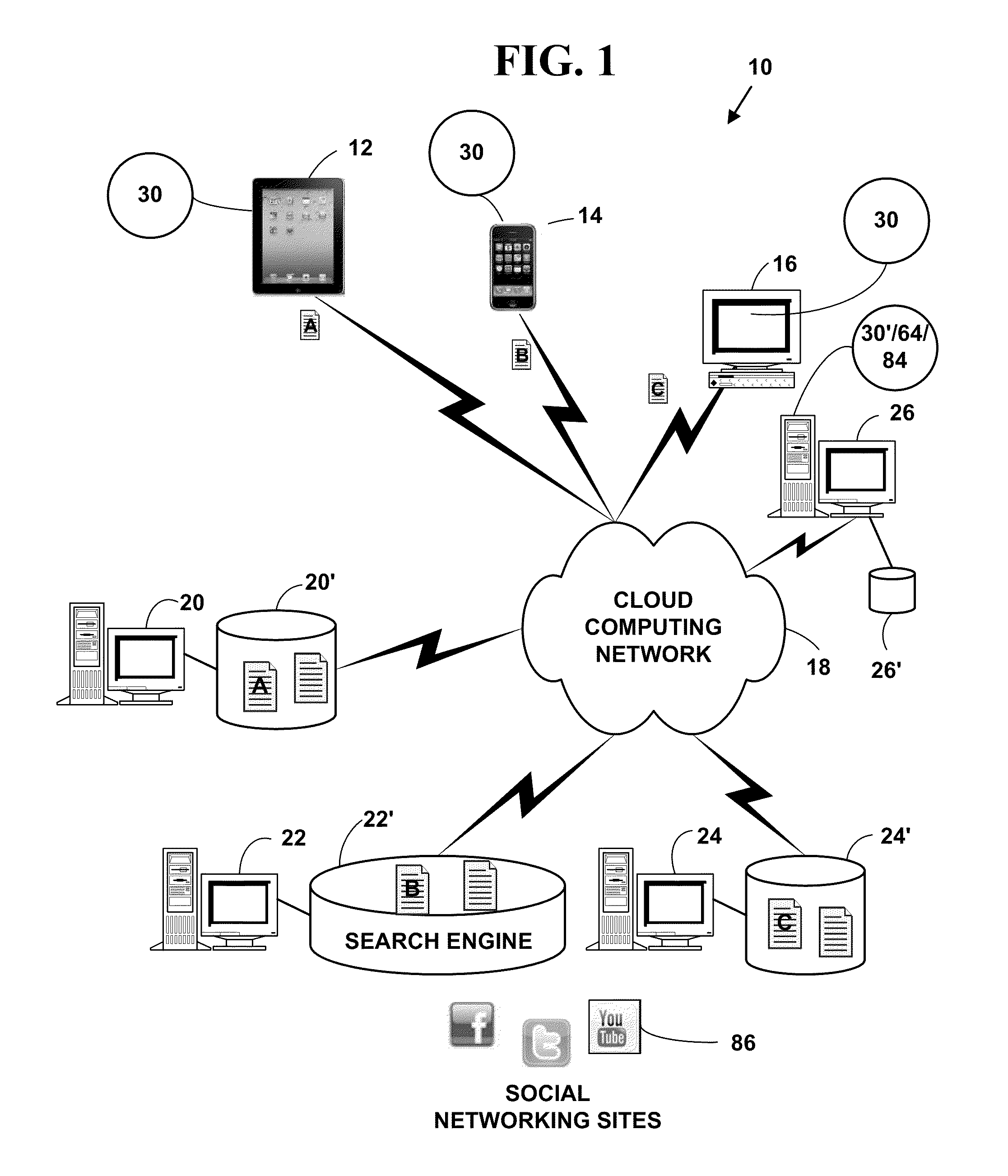

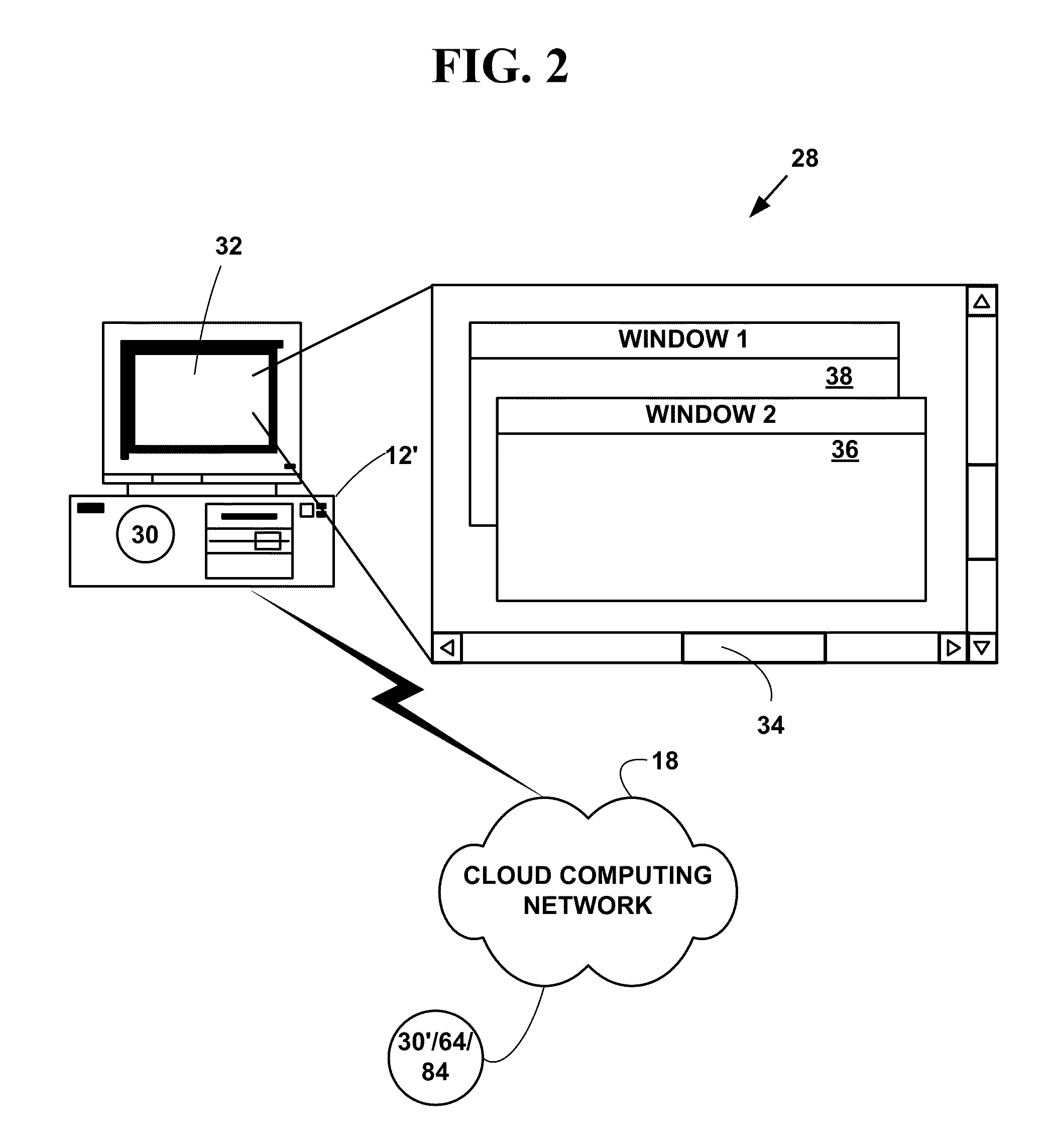

Method and system for creating vertical search engines with cloud computing networks

InactiveUS20110208710A1ImproveLess bandwidthWeb data indexingDigital data processing detailsBroadband networksElectronic information

A method and system for creating vertical search engines with cloud computing networks. The cloud computing networks include a cloud communications network using public networks, private networks, community networks and hybrid networks. The cloud communications network provides on-demand vertical search services, broadband network access, resource pooling, rapid elasticity and measured electronic services for vertical search engines. The method and system dramatically improve a vertical search engine infrastructure used by searchers by providing vertical electronic information using less bandwidth and less processing cycles via the cloud communications network than via a non-cloud communications network. Custom vertical search engines can be created by a user with QR bar codes and other types of bar codes and other types of custom information.

Owner:LESAVICH ZACHARY C

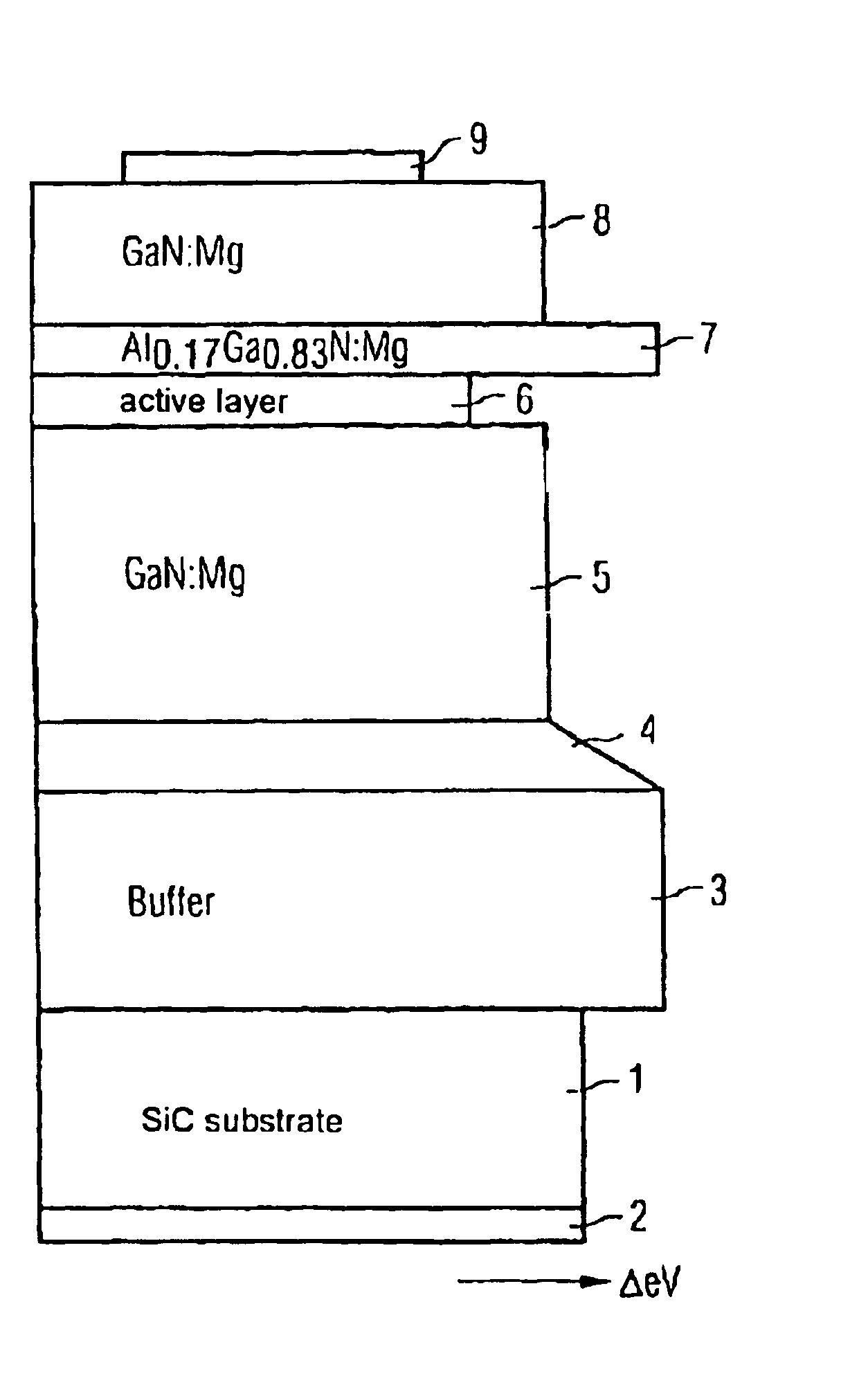

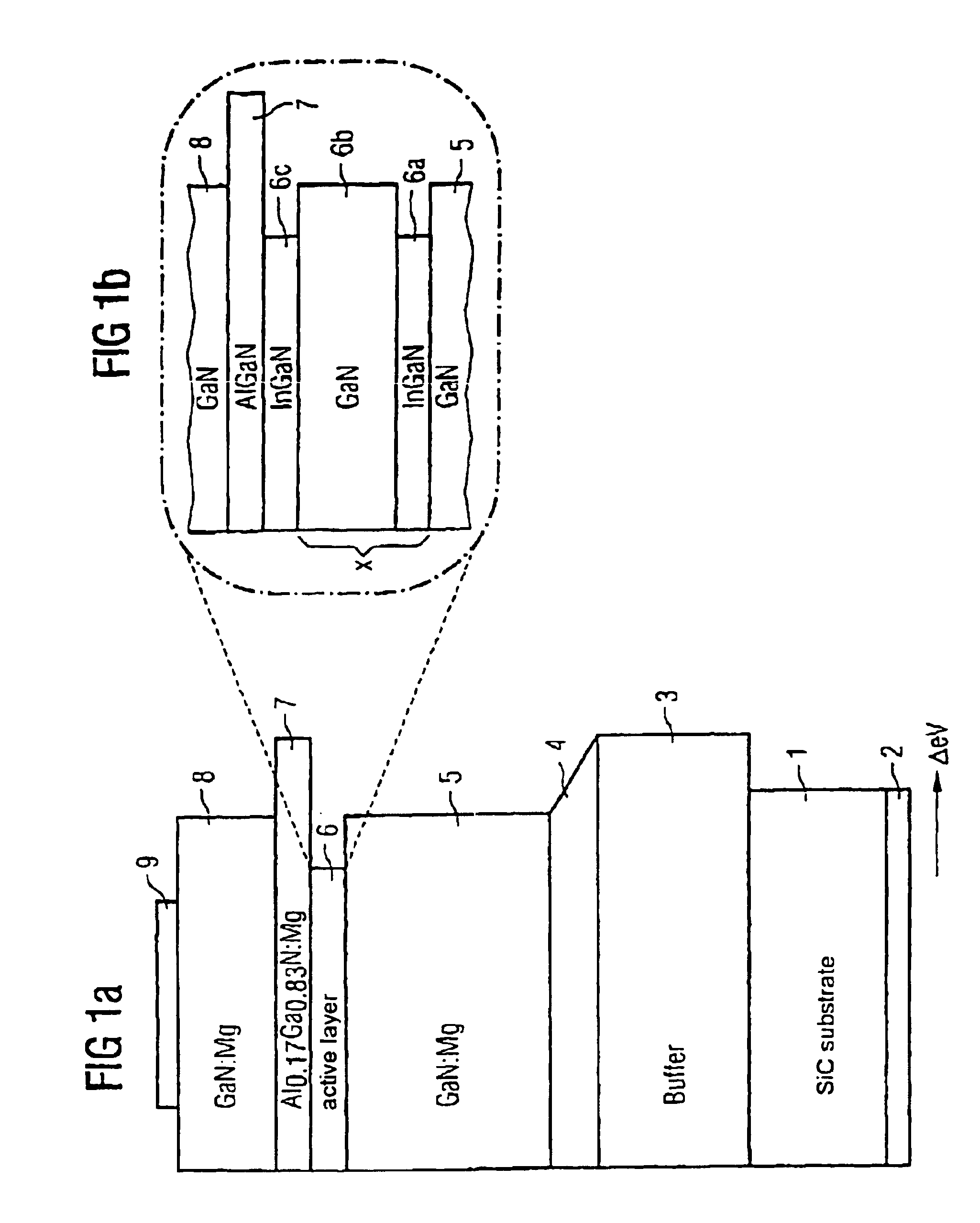

Optical semiconductor device comprising a multiple quantum well structure

InactiveUS6849881B1ImproveIncrease contentLaser detailsLaser active region structureMultiple quantumElectronic energy

An optical semiconductor device with a multiple quantum well structure, is set out in which well layers and barrier layers, comprising various types of semiconductor layers, are alternately layered. The device well layers comprise a first composition based on a nitride semiconductor material with a first electron energy. The barrier layers comprise a second composition of a nitride semiconductor material with electron energy which is higher in comparison to the first electron energy. The well and barrier layers are in the direction of growth, by a radiation-active quatum well layer which with the essentially non-radiating well layers (6a) and the barrier layers (6b), arranged in front, form a supperlattice.

Owner:OSRAM OLED

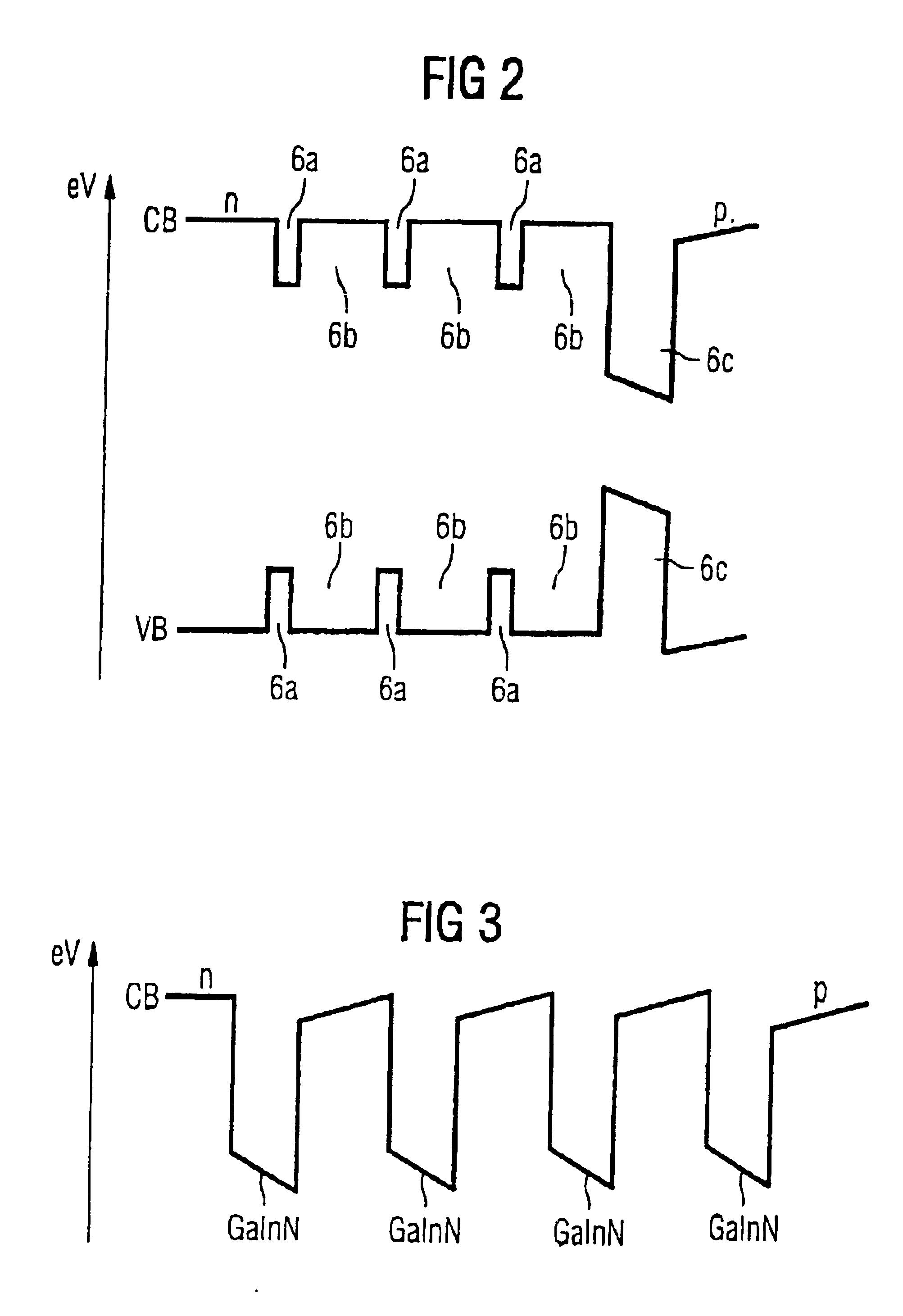

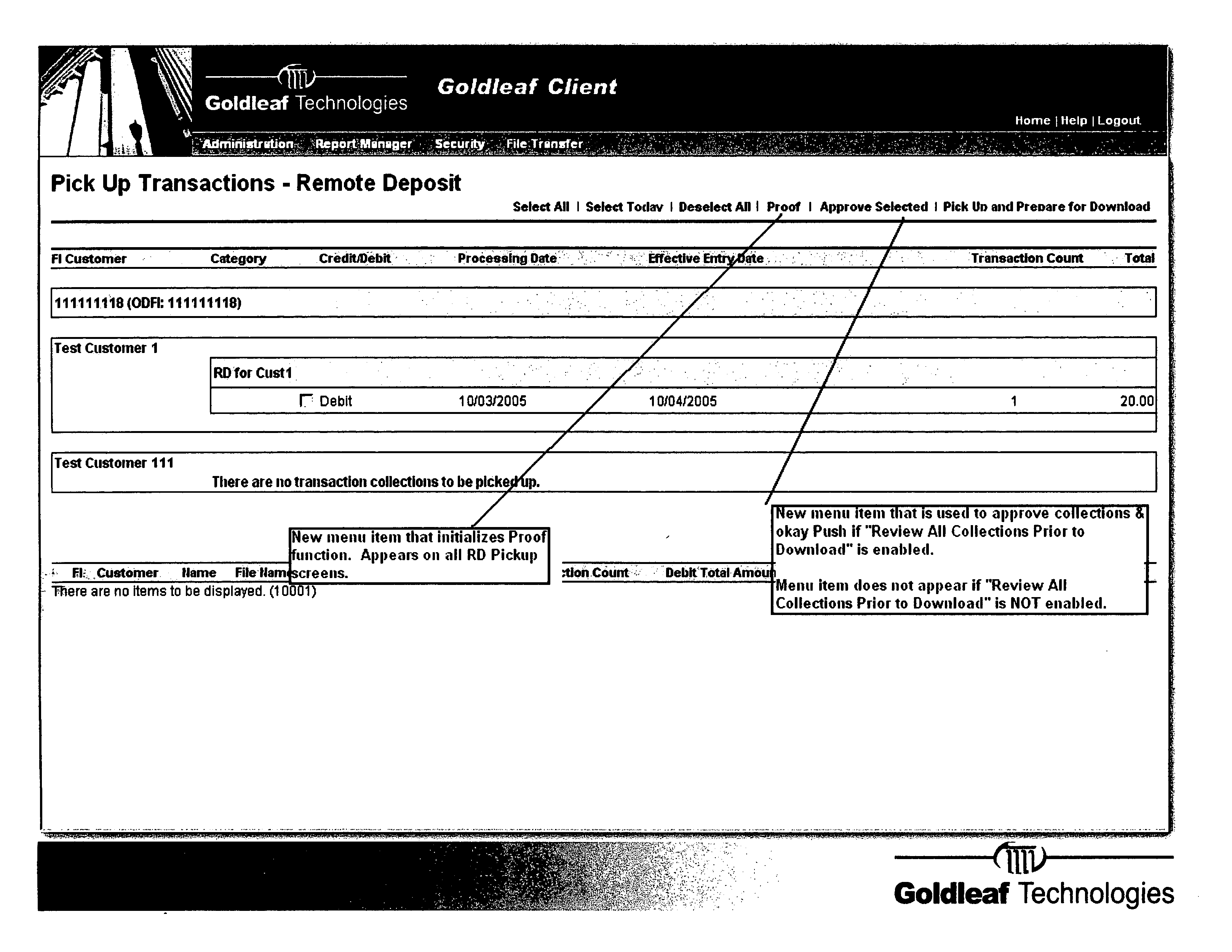

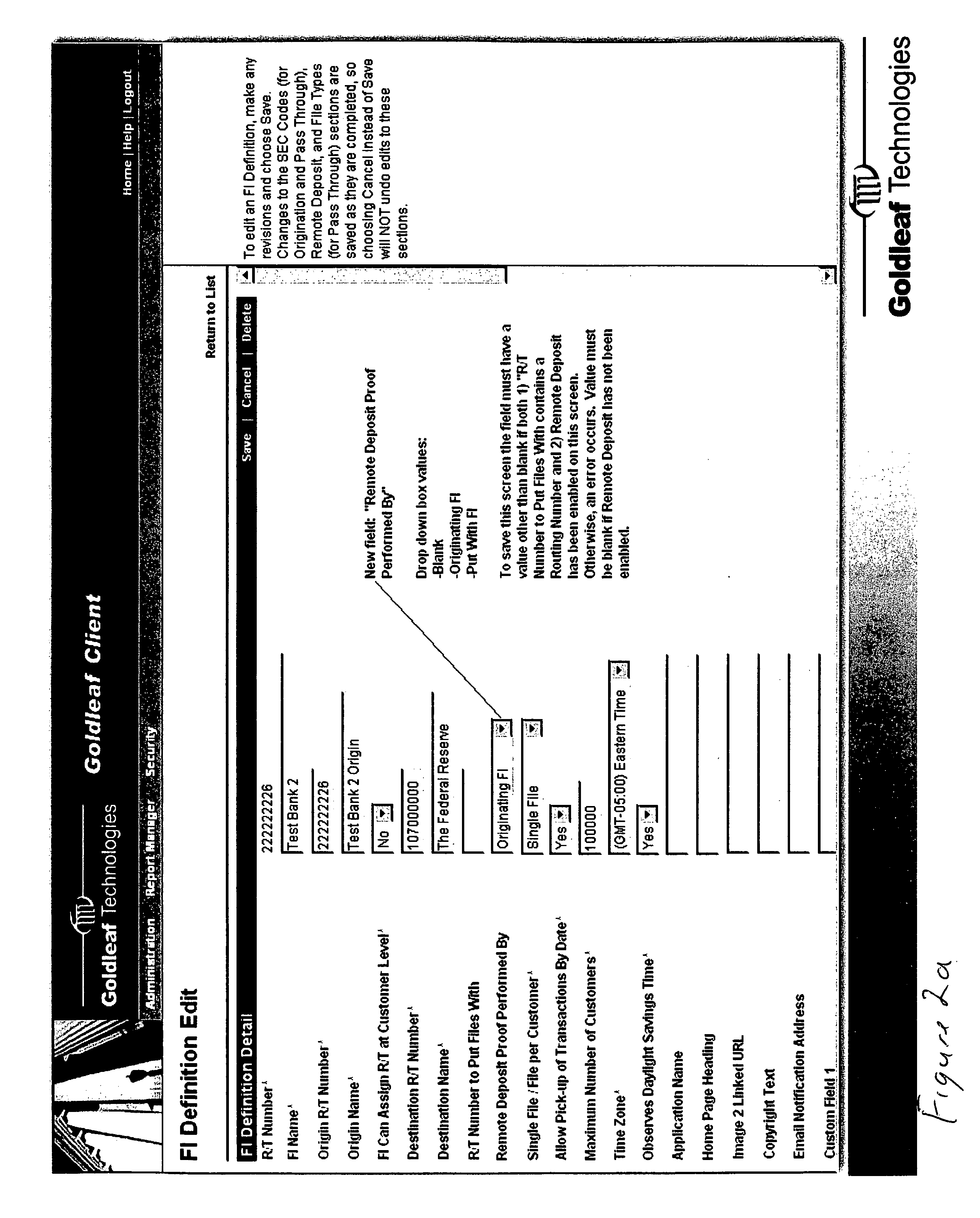

Remote check deposit

In accordance with the principles of the present invention, a system is provided for capturing a customer deposit at their place of business, converting the Magnetic Ink Character Recognition (MICR) data encoded documents into an image with an associated data file, and electronically transmit the data to a financial institution. The system allows the customer to scan each MICR encoded check that is to be deposited with their financial institution, which captures financial institution routing information and customer account information. The associated image the physical check can be franked denoting the check has been electronically processed to avoid further processing. The resulting image and account data can then be edited and processed by the financial institution. There are three options for encoding the amount: 1) the customer enters each amount after scanning the item prior to sending to the financial institution; 2) the financial institution enters the amount of each item after receiving the file from the customer; and 3) the amount field(s) is scanned and the amount is automatically entered. The system allows for both 1) online (Internet) capture of the MICR data and the associated image or 2) offline capture and the subsequent importing of the image and MICR data for transmission to the financial institution via the Internet. The financial institution can review the items captured online, and repair any item that is incorrect. The financial institution can use the system to print substitute checks that confirm to ANSI X9.90 for processing or deliver an electronic file in ANSI X9.37 format to any check processing system. The system includes secure transport over Internet connections for file transfer and dual control security to reduce fraudulent transactions from being initiated by the customer.

Owner:GOLDLEAF TECH

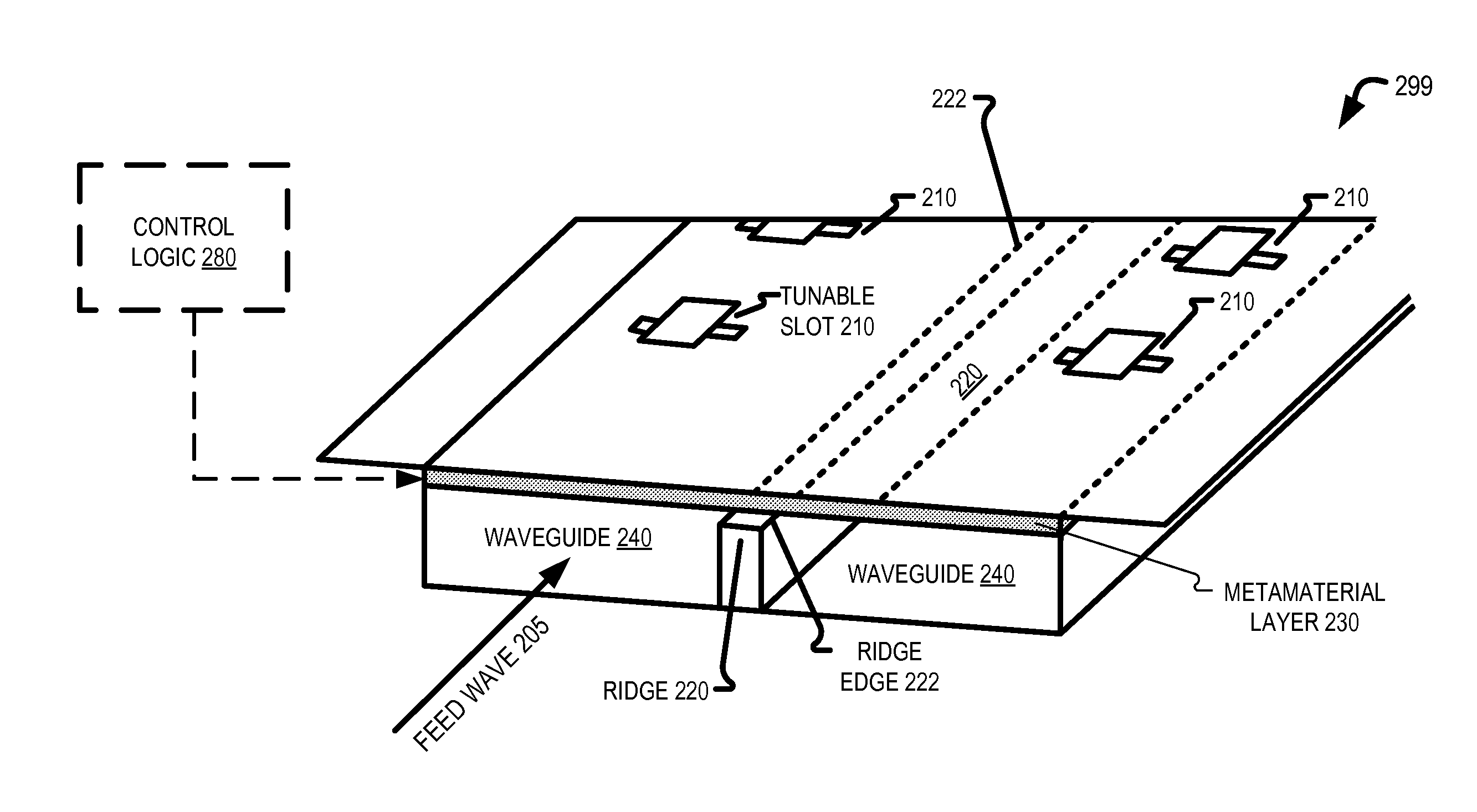

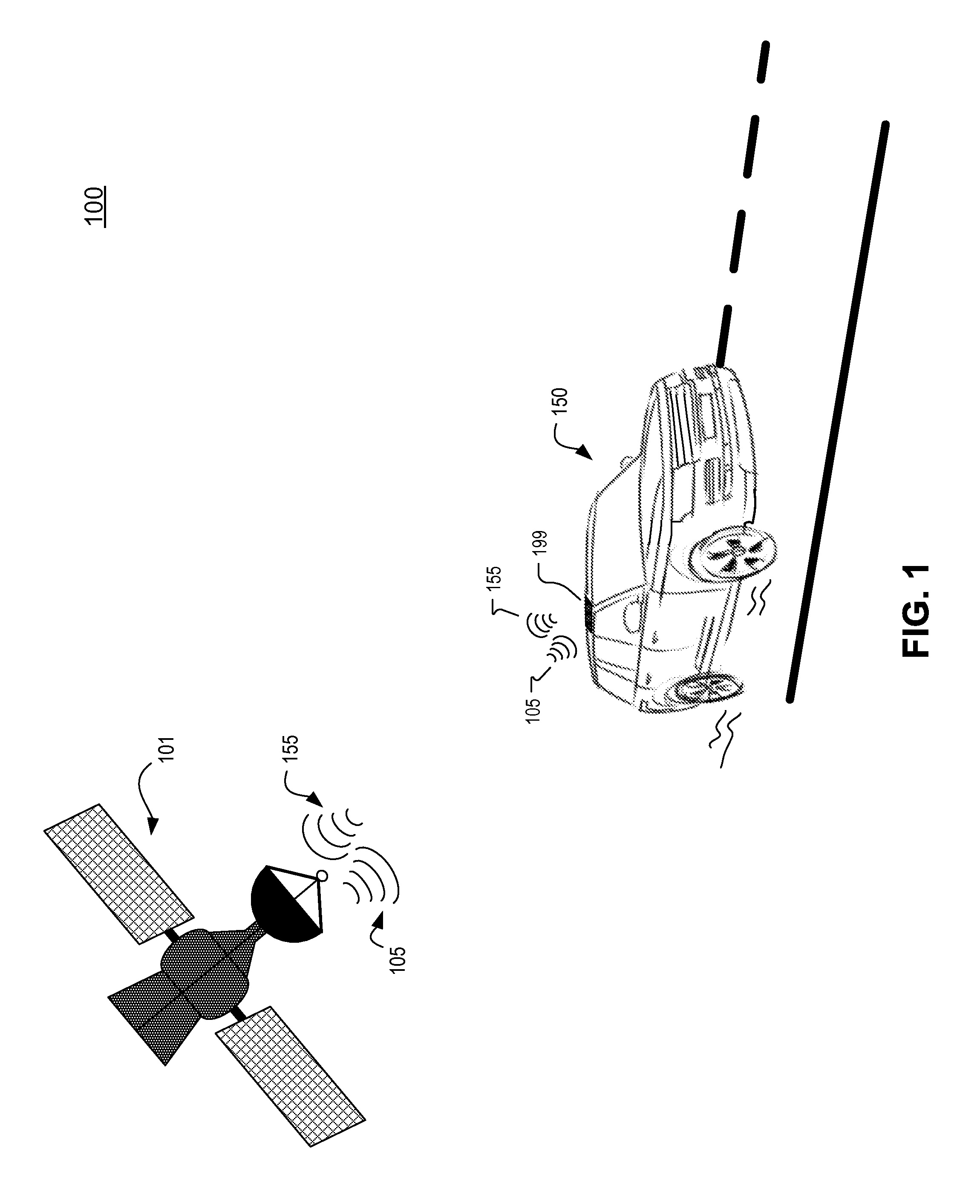

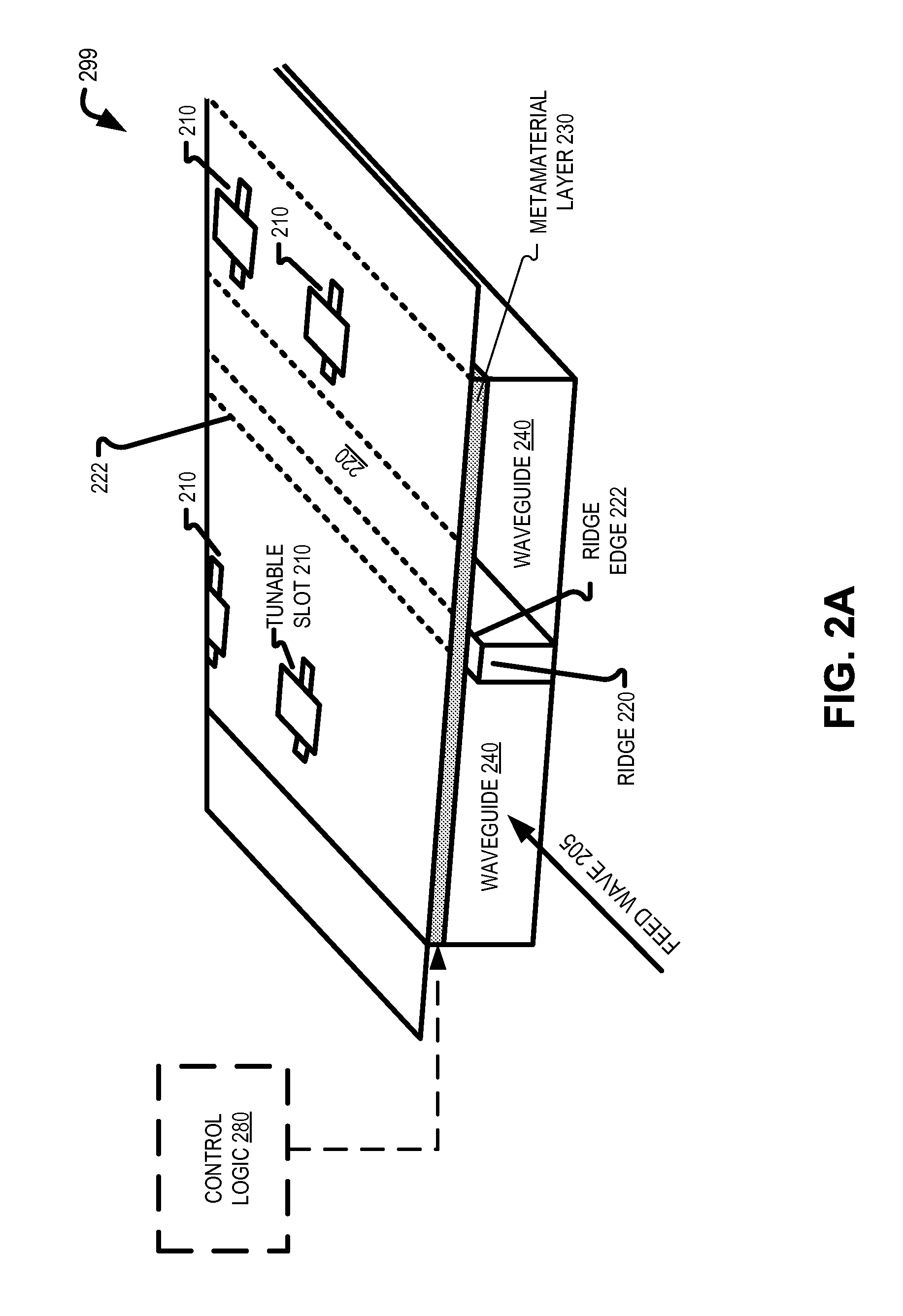

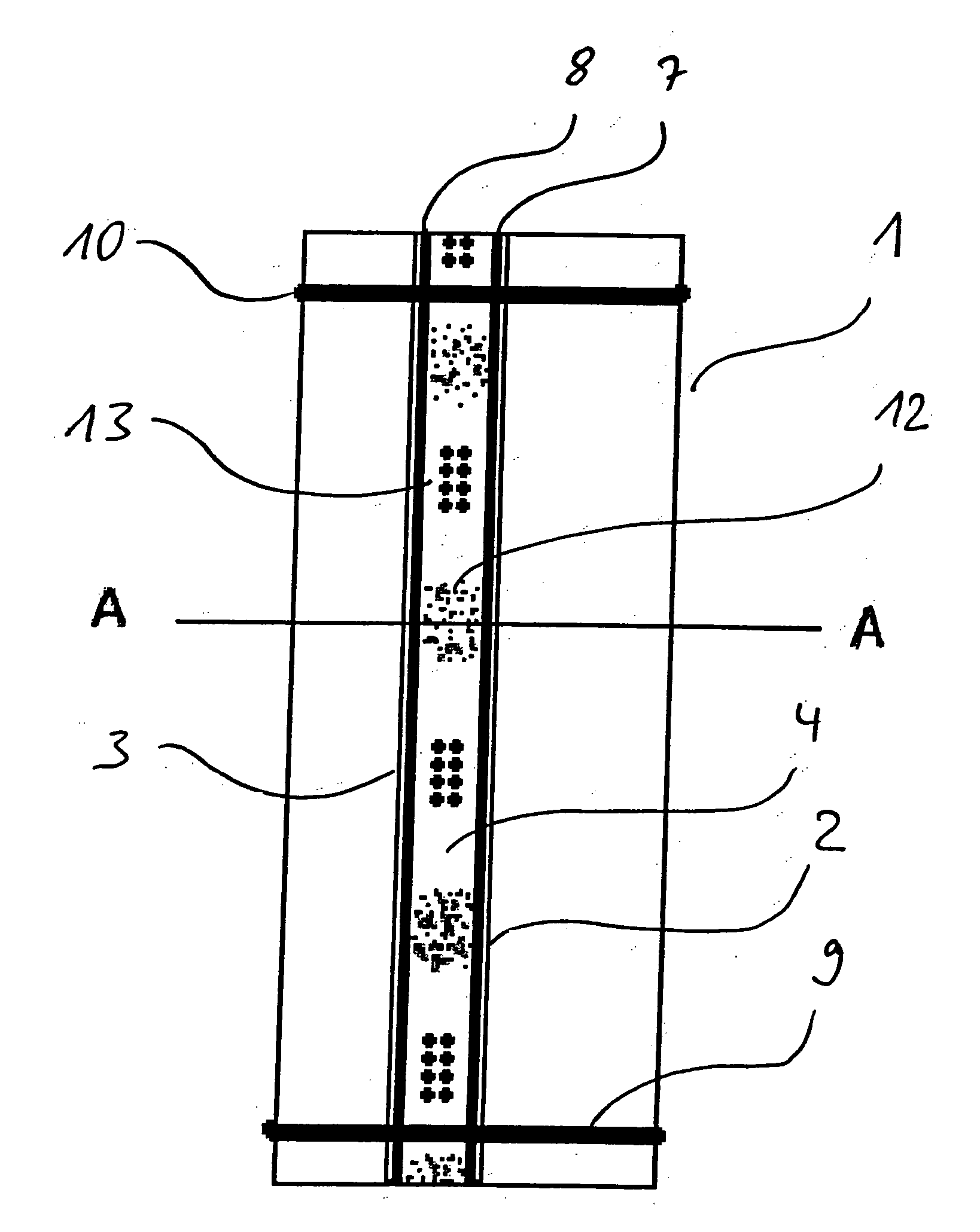

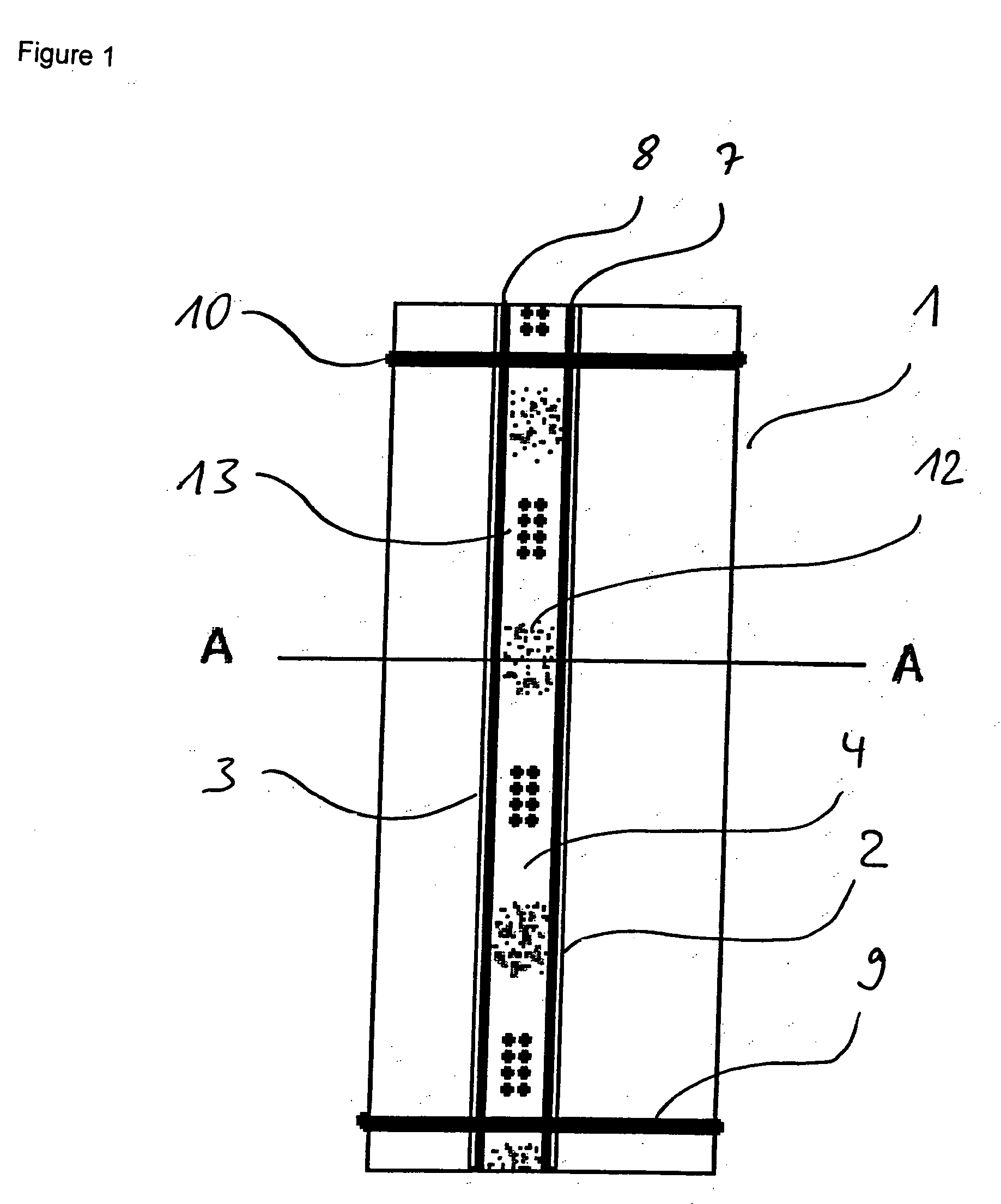

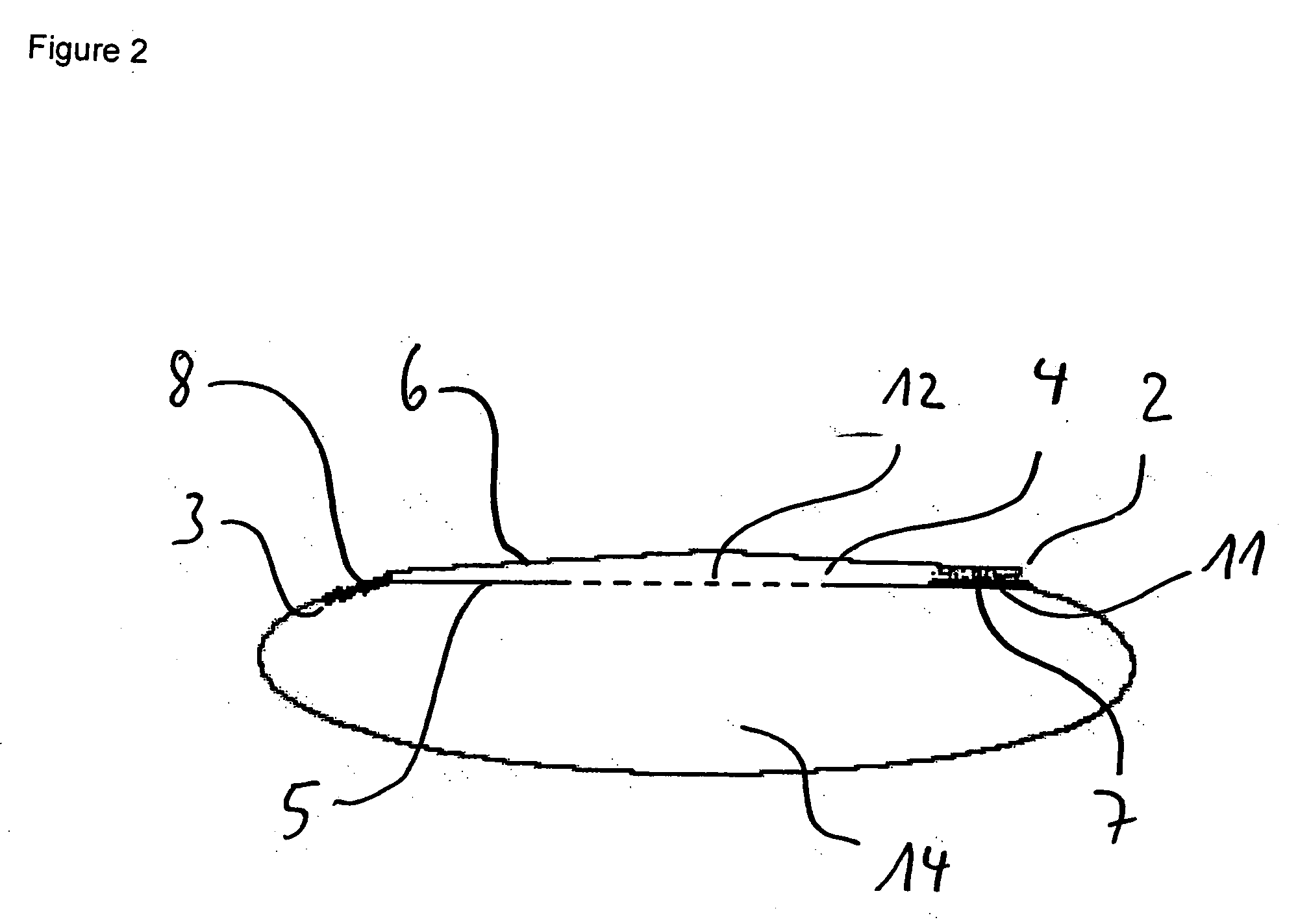

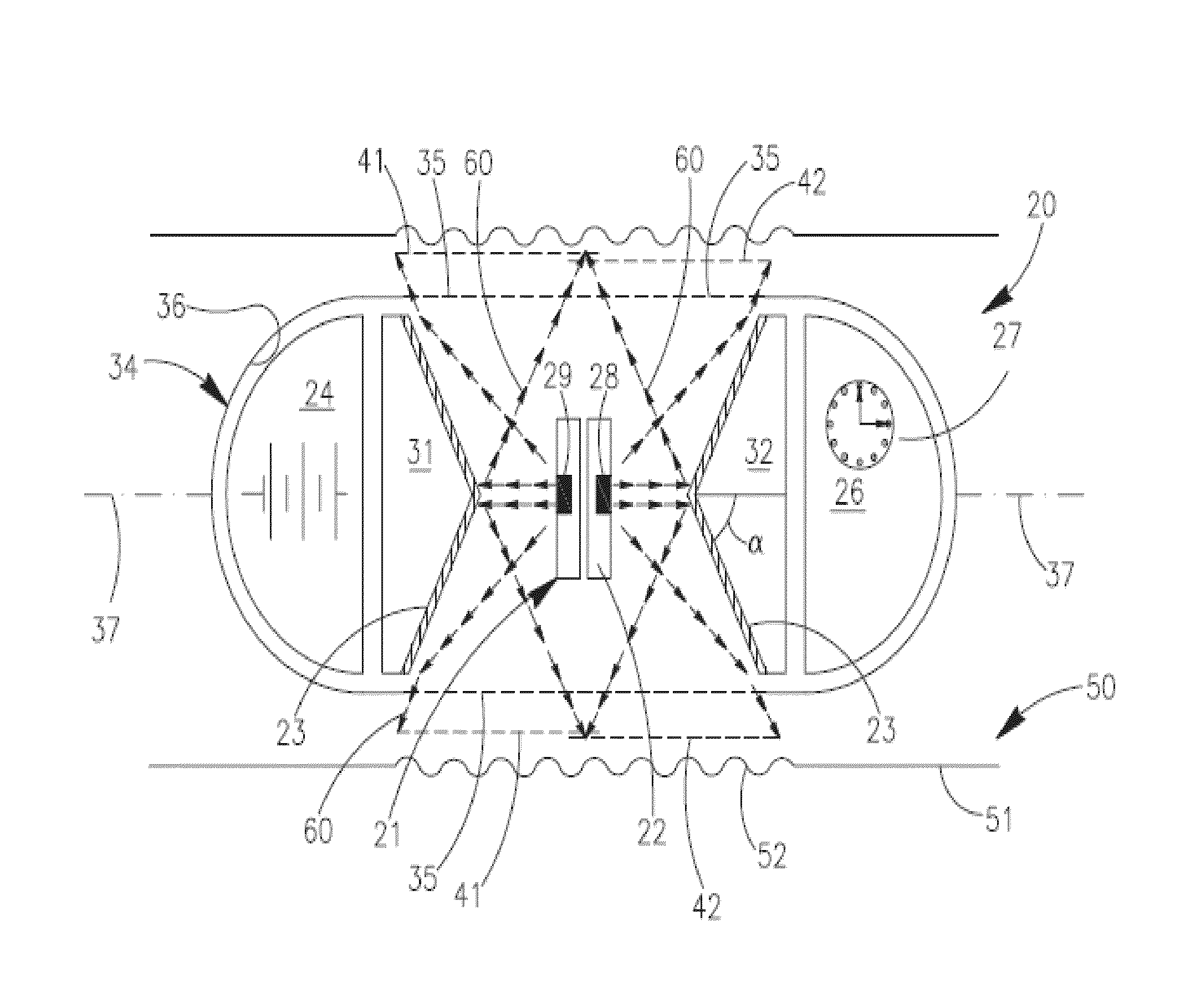

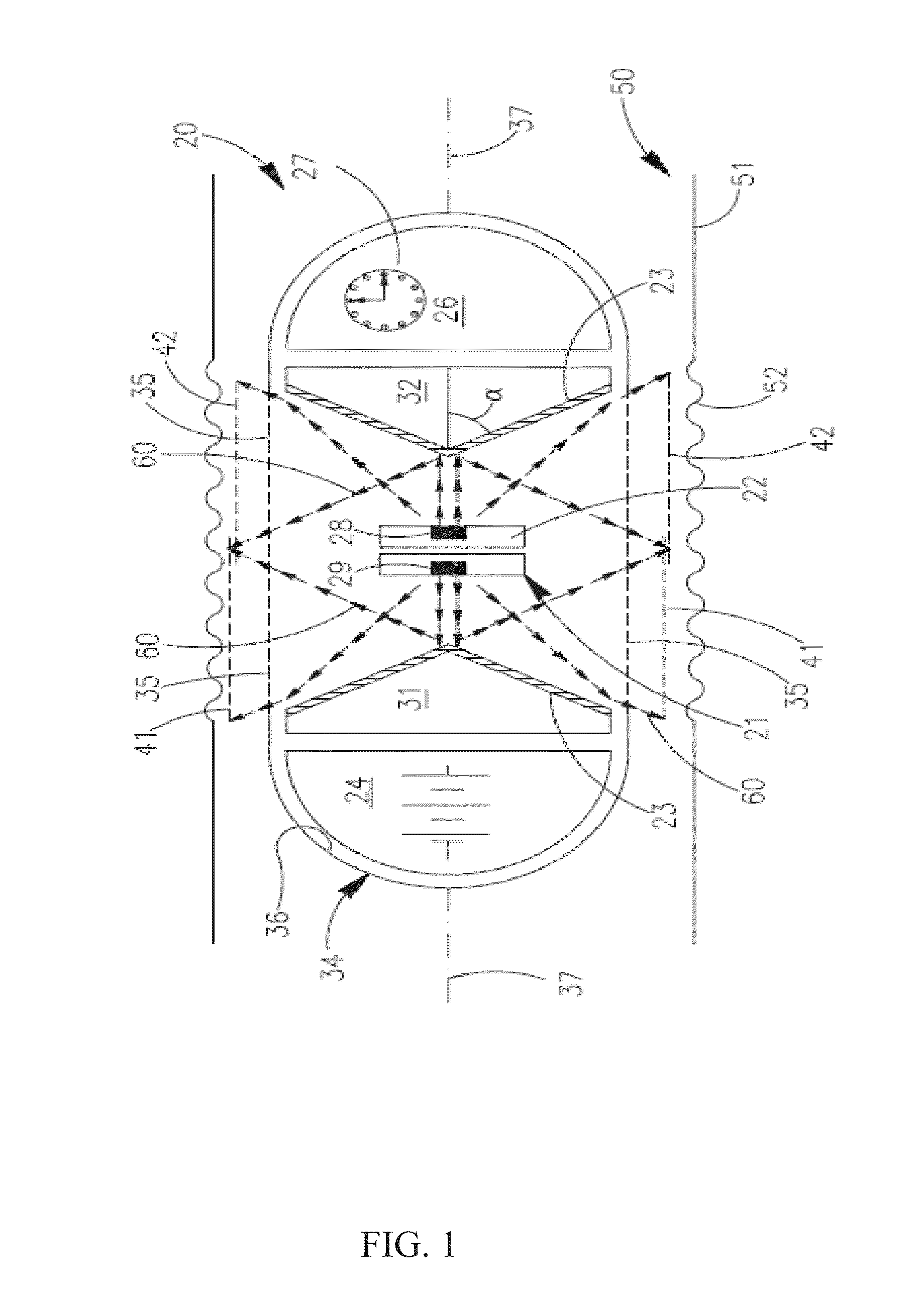

Beam shaping for reconfigurable holographic antennas

A reconfigurable holographic antenna and a method of shaping an antenna beam pattern of a reconfigurable holographic antenna is disclosed. A baseline holographic pattern is driven onto a reconfigurable layer of the reconfigurable holographic antenna while a feed wave excites the reconfigurable layer. An antenna pattern metric representative of a baseline antenna pattern is received. The baseline antenna pattern is generated by the reconfigurable holographic antenna while the baseline holographic pattern is driven onto the reconfigurable layer. A modified holographic pattern is generated in response to the antenna pattern metric. The modified holographic pattern is driven onto the reconfigurable layer of the reconfigurable holographic antenna to generate an improved antenna pattern.

Owner:KYMETA

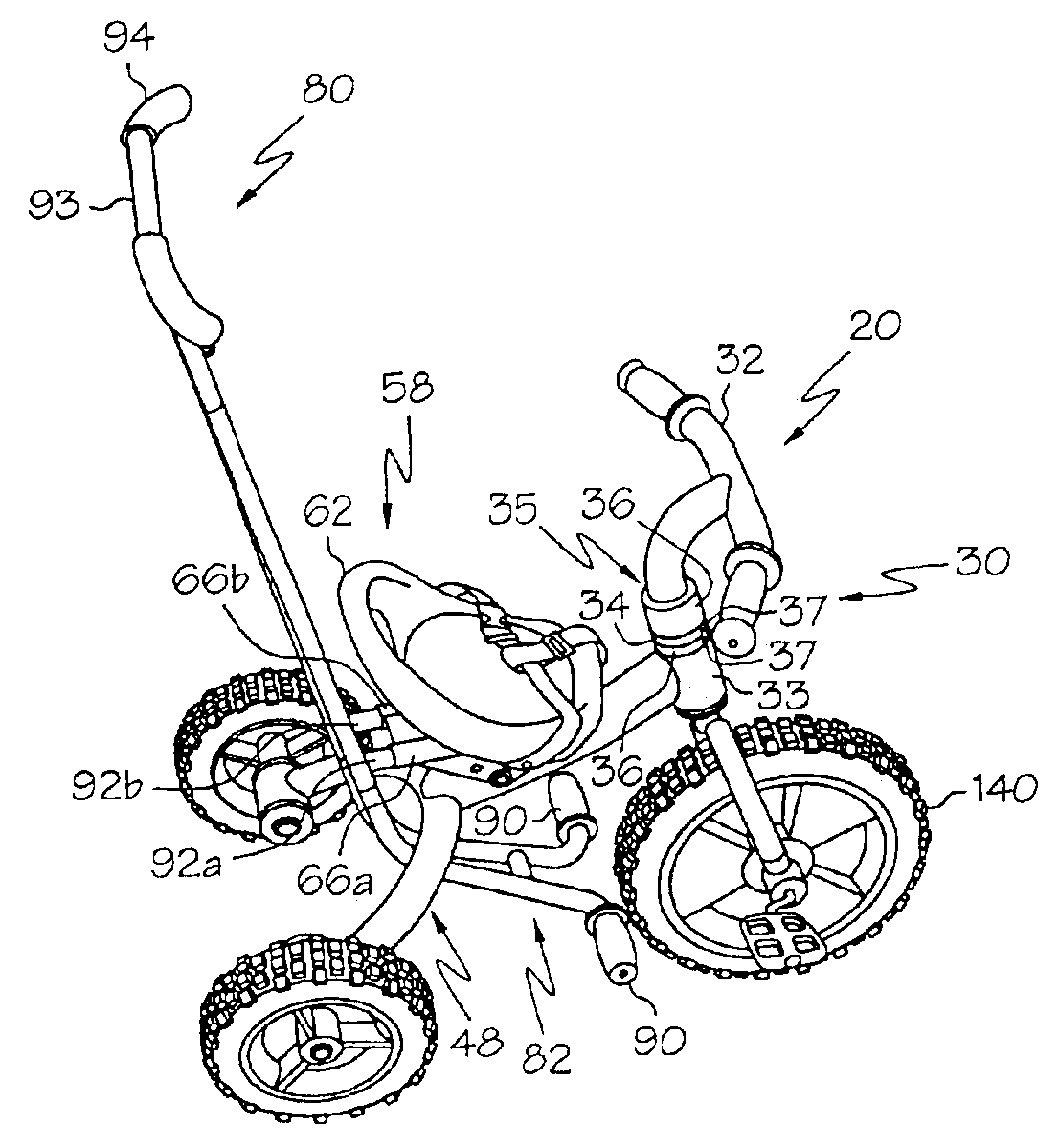

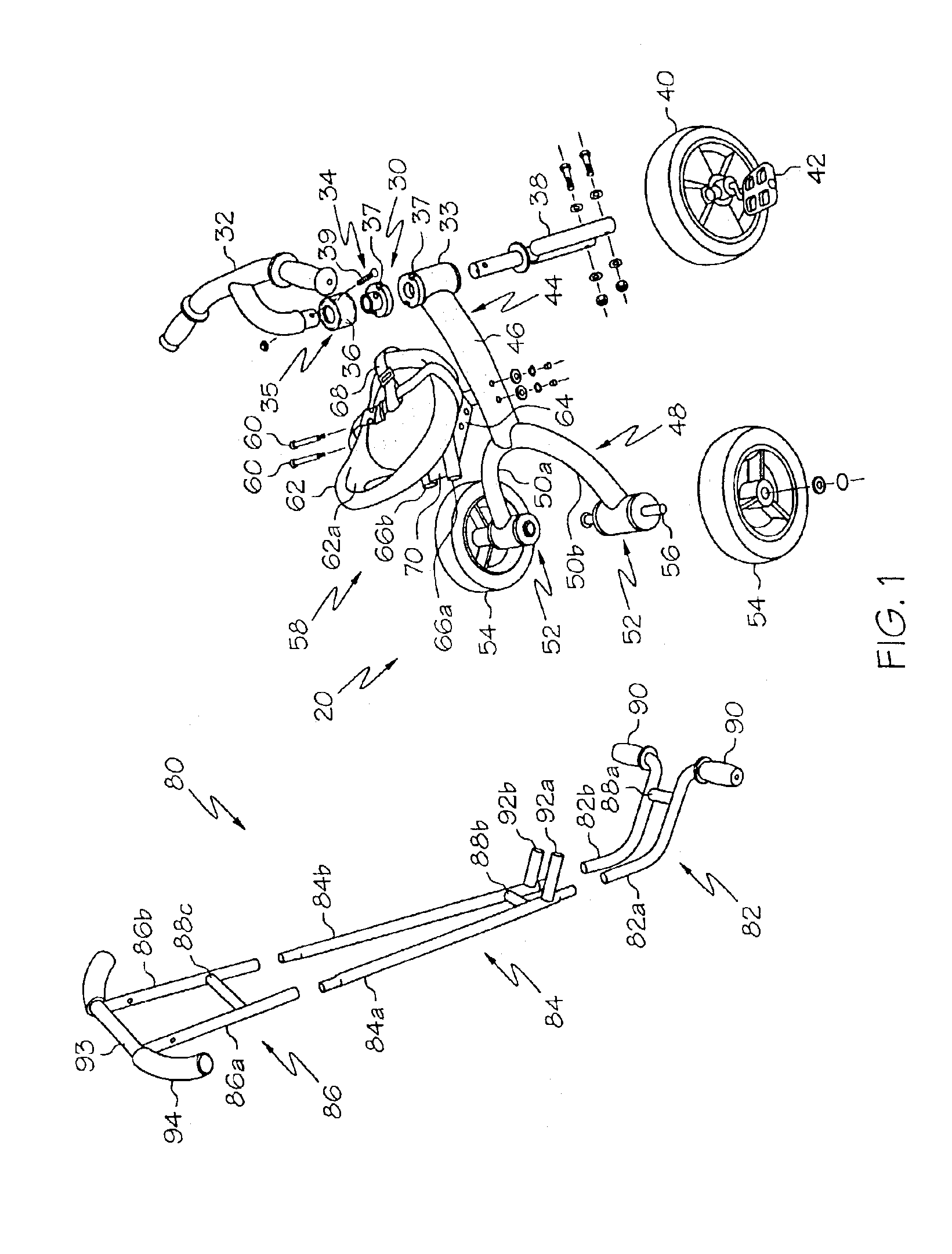

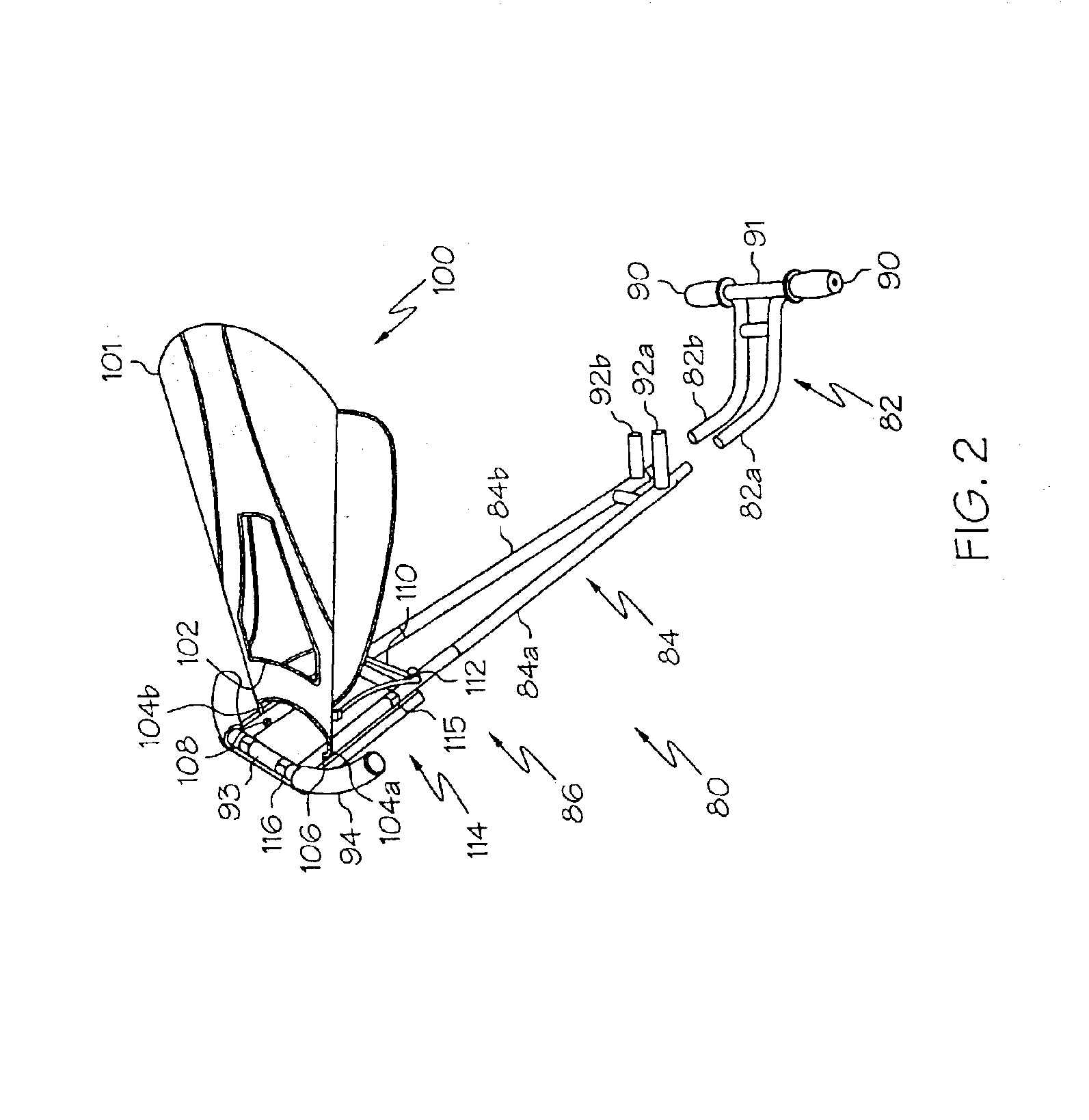

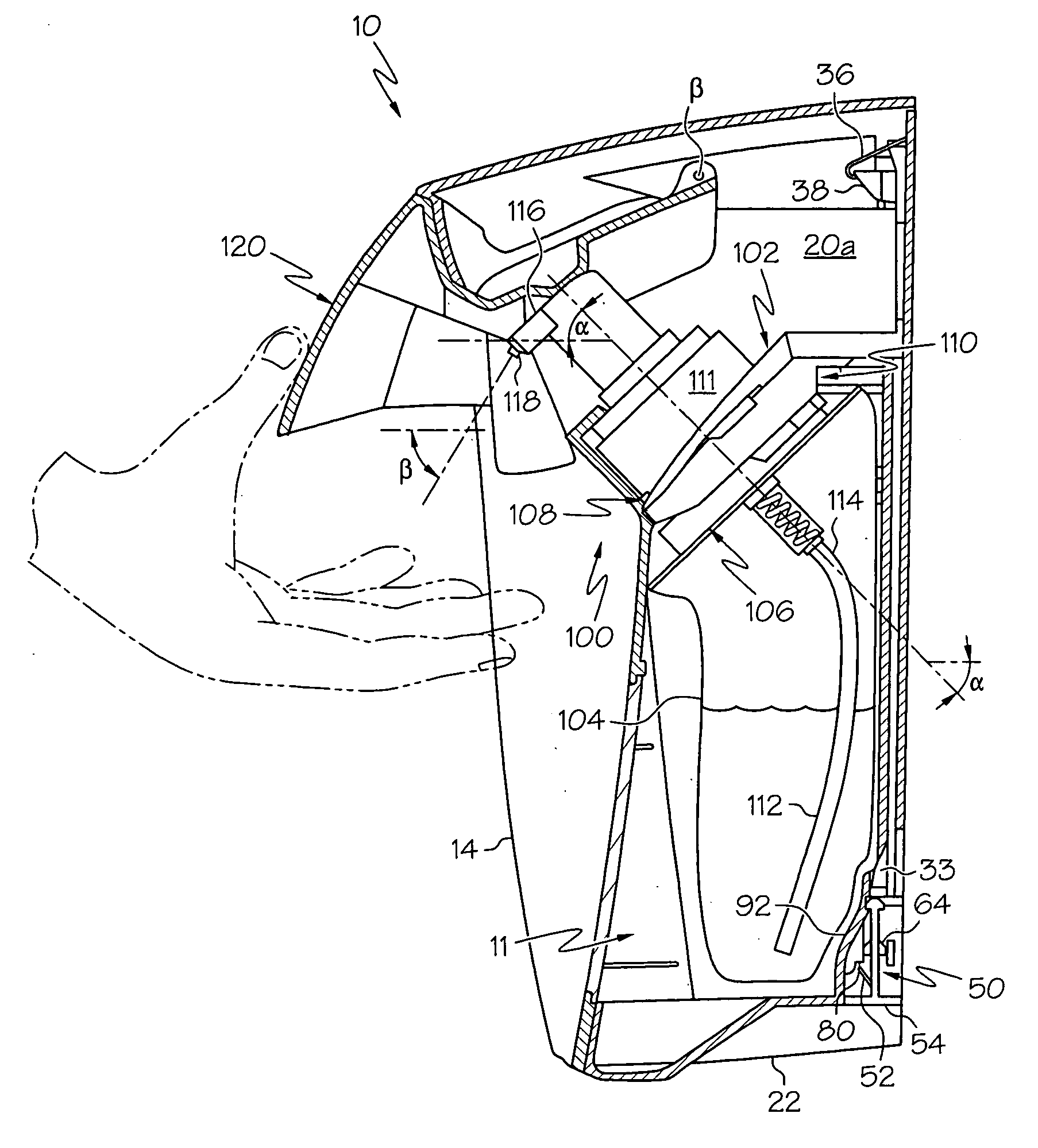

Tricycle and guide handle

A tricycle includes a mainframe with front and rear sections. The front section may include a steering assembly with a rotatable wheel. The rear section may provide support for two spaced wheels and may be configured to provide a substantially unencumbered open area between the spaced wheels. The tricycle features a guide handle removeably connected to the tricycle and having a pair of footrests integrally connected to the guide handle adjacent a lower end.

Owner:HUFFY CORP

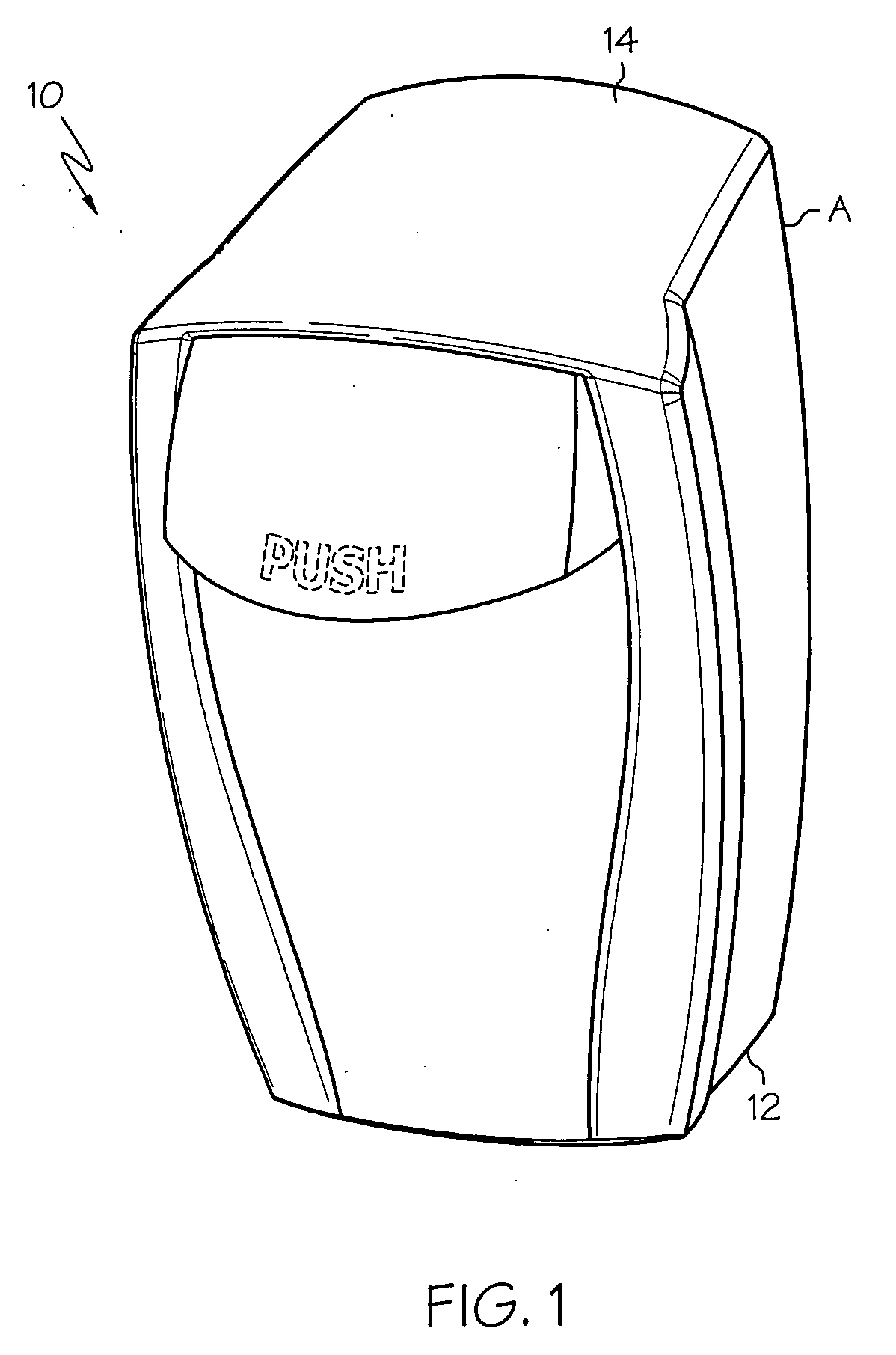

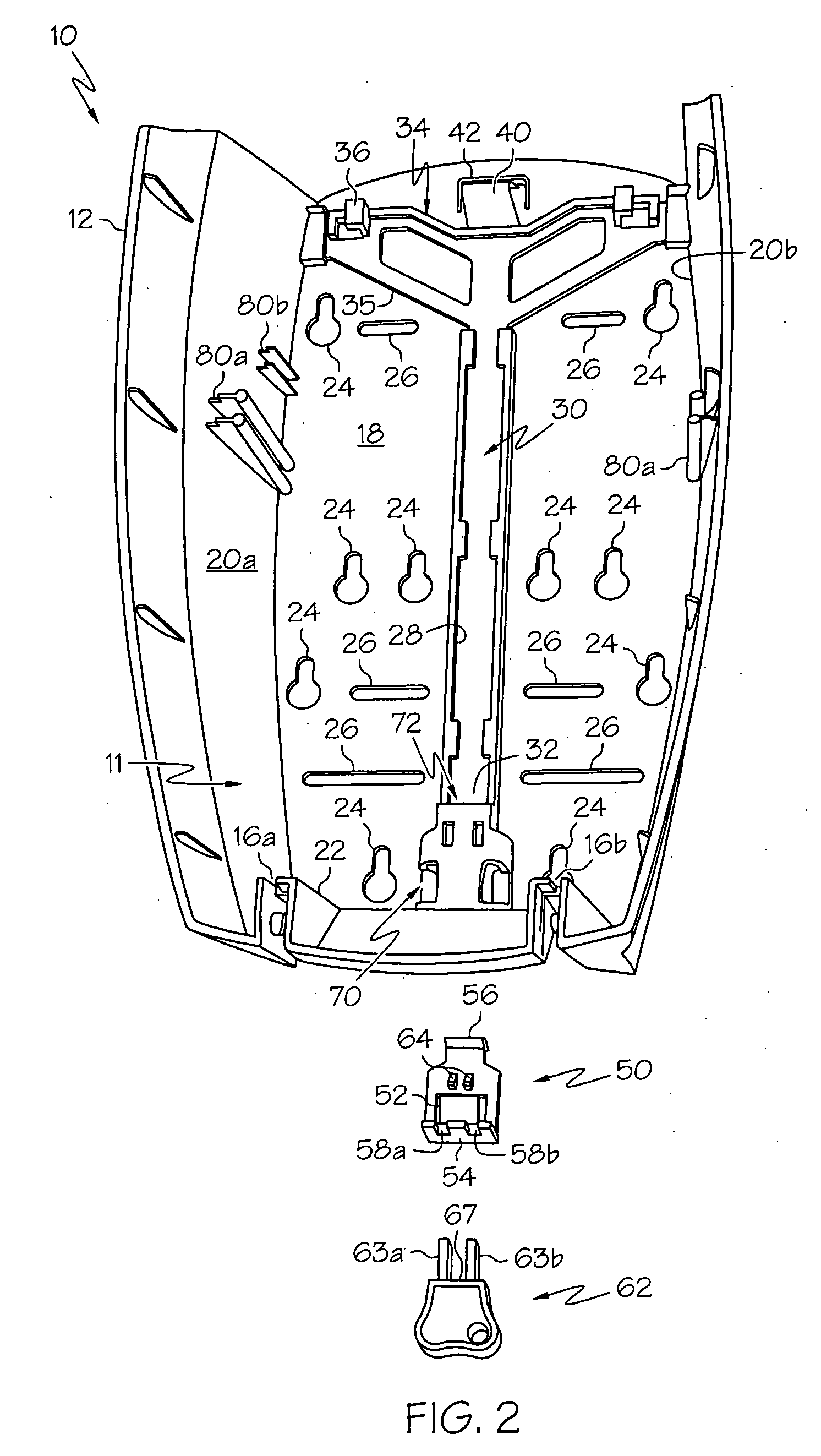

Refillable product dispenser and system

InactiveUS20050284888A1ImproveContracting/expanding measuring chambersLarge containersEngineeringFront cover

A refillable product dispenser includes a housing having a frame and a front cover with open and closed positions relative to the frame, a receptacle associated with the housing, and a pushbutton configured to be at least partially received by the receptacle in one of alternative unlocked and locked orientations. The dispenser further includes a dispensing system with a product container having a spout disposed at a first dispensing angle, a nozzle disposed at a second dispensing angle and a dispensing lever configured to activate the spout when force is applied to the lever.

Owner:ALUTA

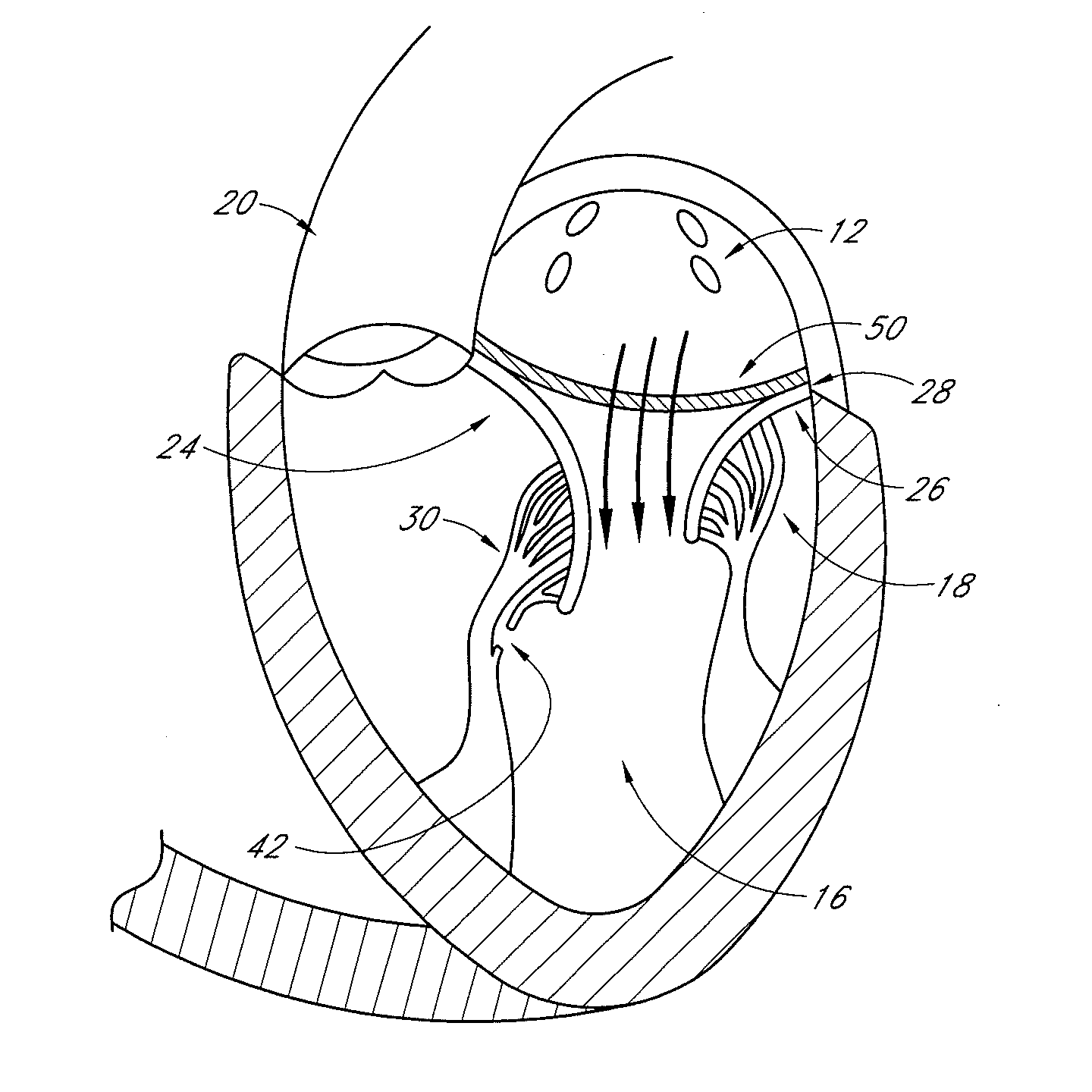

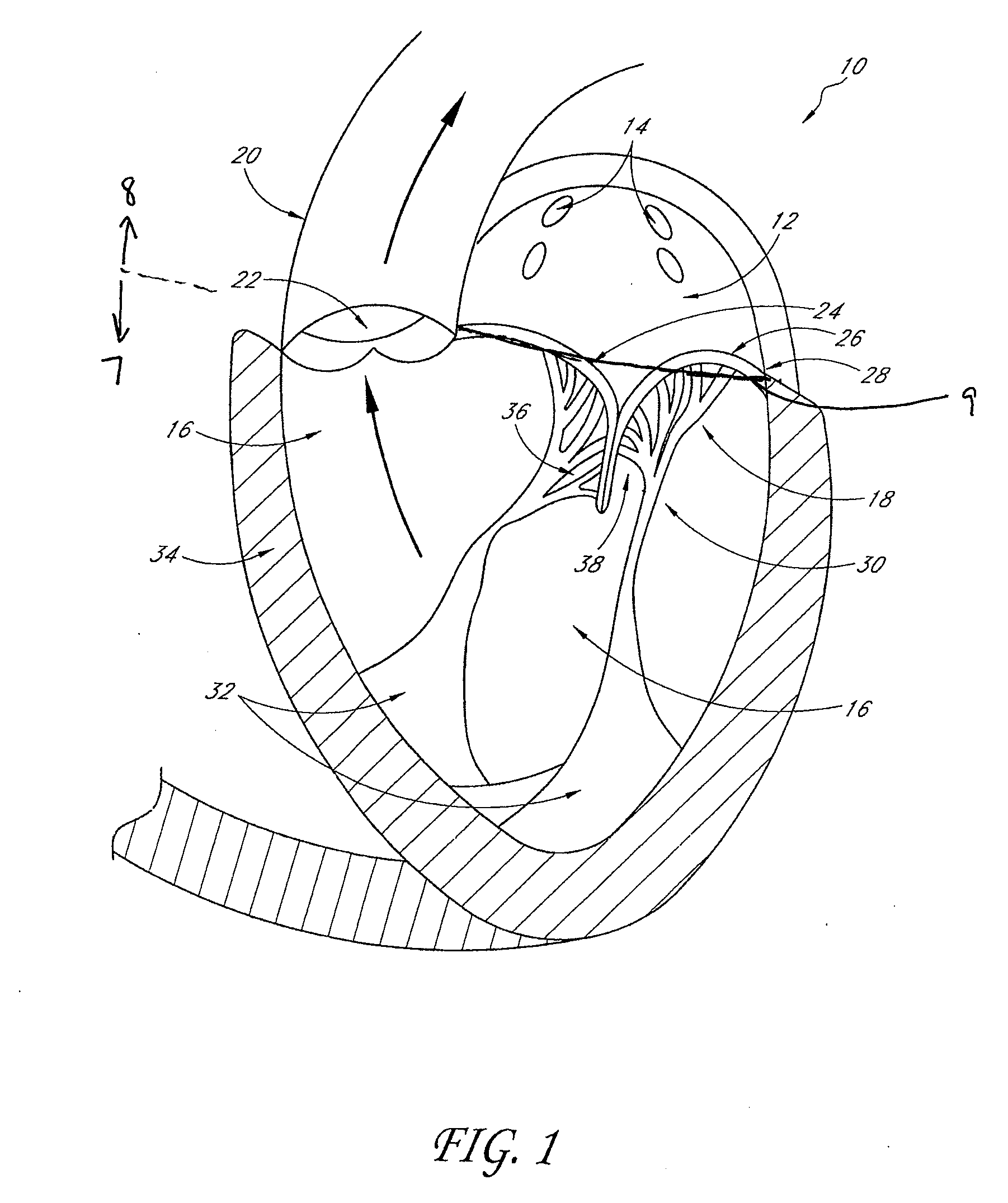

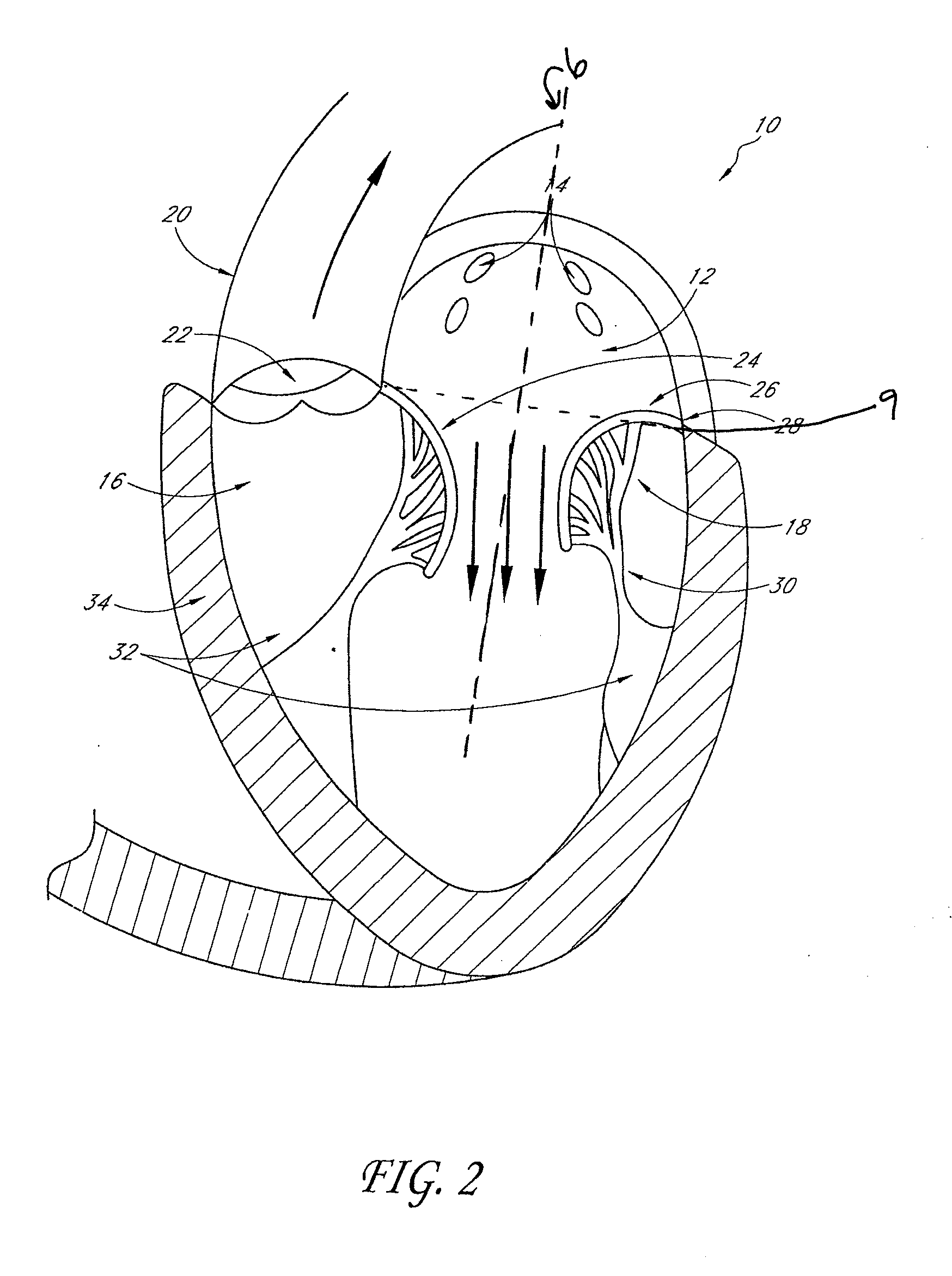

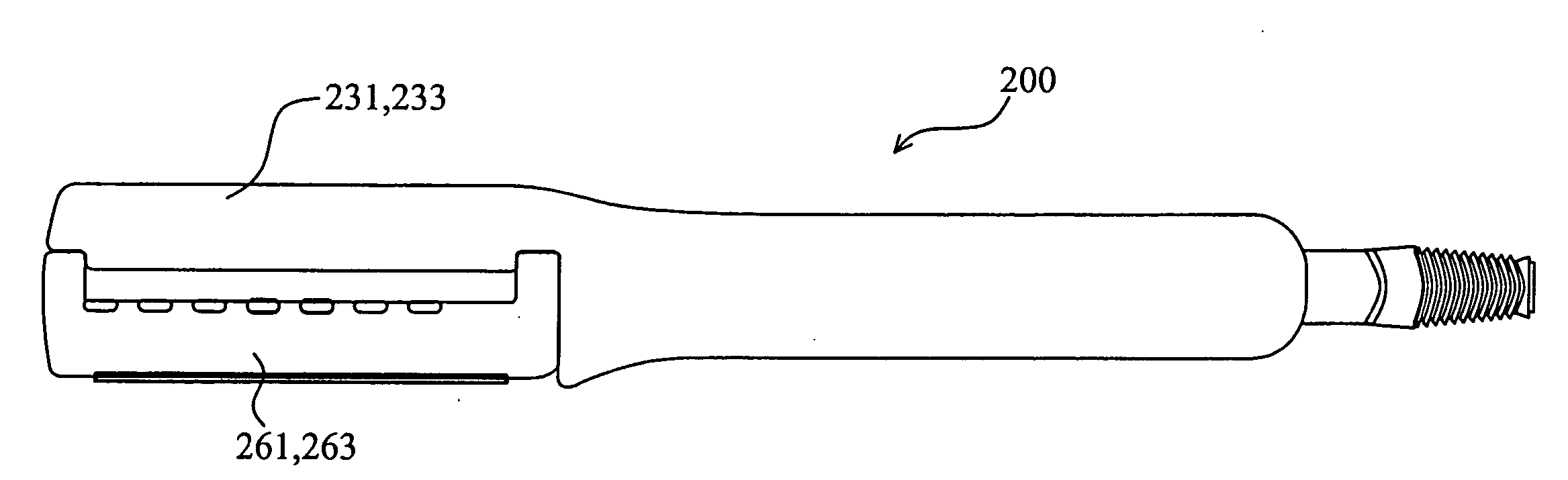

Transvalvular intraannular band for aortic valve repair

InactiveUS20100131057A1ImproveReduce distanceBone implantAnnuloplasty ringsNeoaortic valveAortic valve repair

Aortic regurgitation can be treating by implanting in the aortic annulus a transvalvular intraannular band. The band has a first end, a first anchoring portion located proximate the first end, a second end, a second anchoring portion located proximate the second end, and a central portion. The central portion is positioned so that it extends transversely across a coaptive edge formed by the closure of the aortic valve leaflets. The band may be implanted via translumenal access or via thoracotomy.

Owner:HEART REPAIR TECH INC

Plastic bag with overpressure relief

ActiveUS20050281493A1ImproveReduced strengthBox making operationsPaper-makingPlastic bagInternal zone

Owner:HEINEMEIER SABINE +2

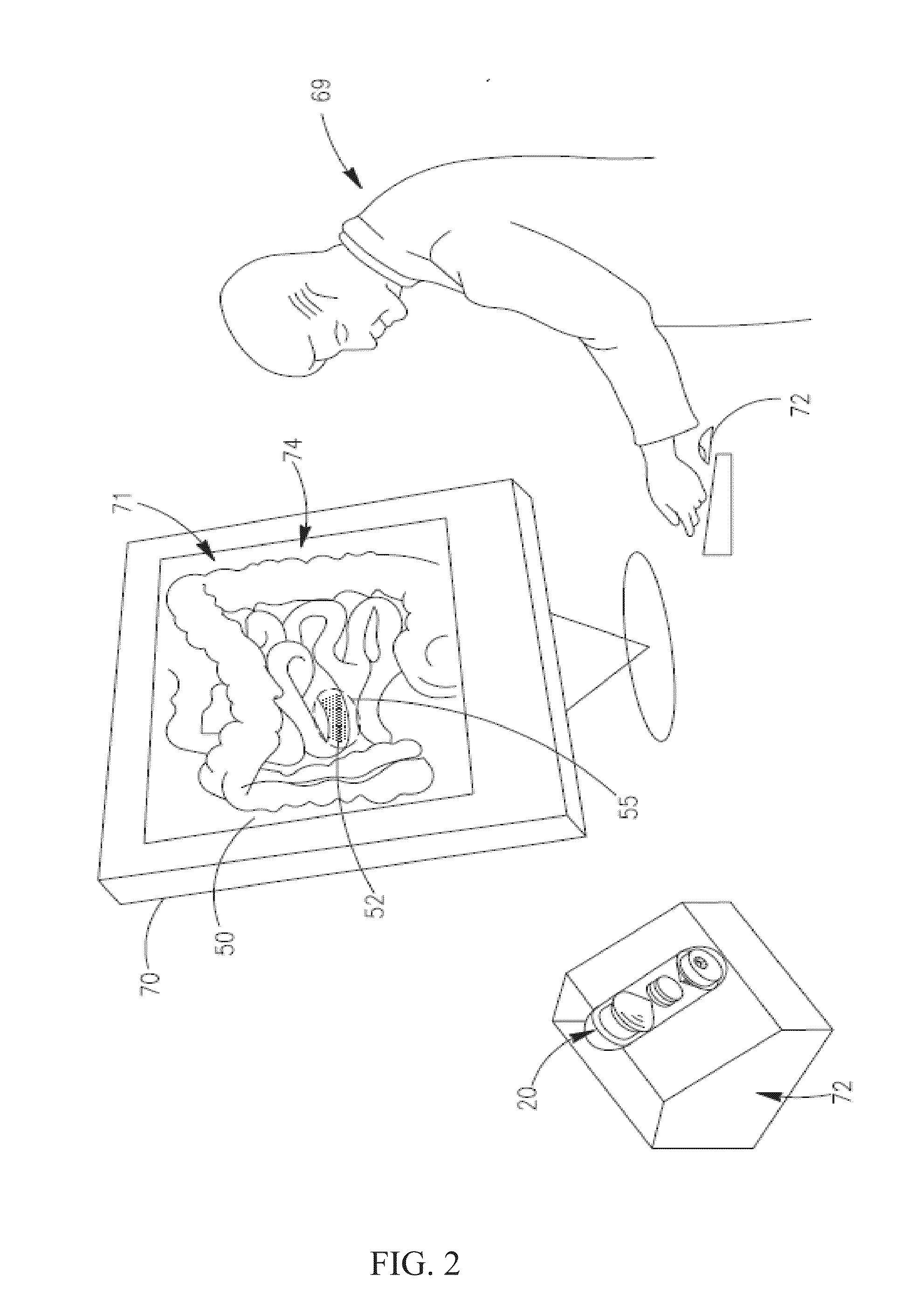

Capsule phototherapy

A swallowable capsule for providing phototherapy to a patient's gastrointestinal (GI) tract, the capsule including a power supply, one or more phototherapeutic light sources, a speed determination unit for calculating speed of movement of the capsule in the GI tract, and a controller unit for activating one or more of the one or more light sources for delivering a therapeutic illumination dose to a target site in the GI tract, based, at least in part, on a determined speed. Related apparatus and methods are also described.

Owner:PHOTOPILL MEDICAL LTD

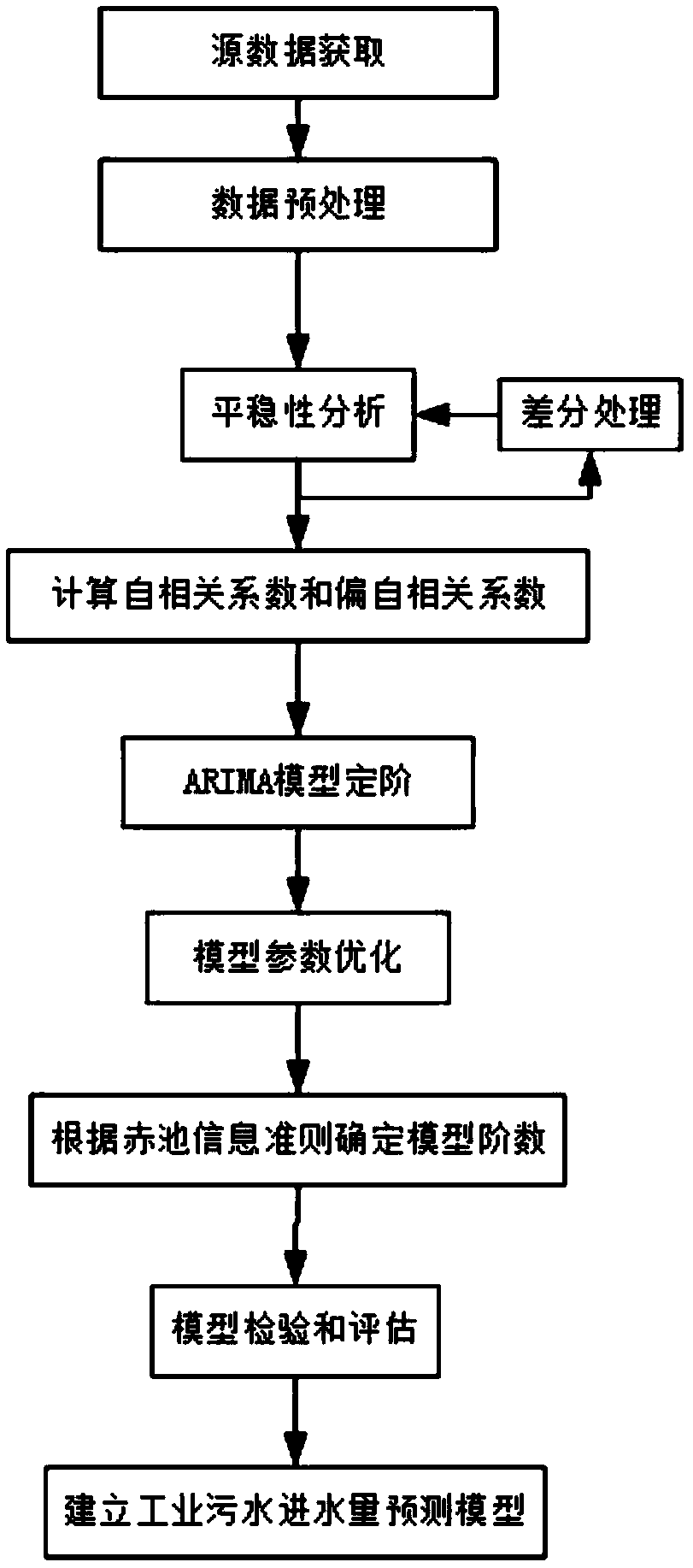

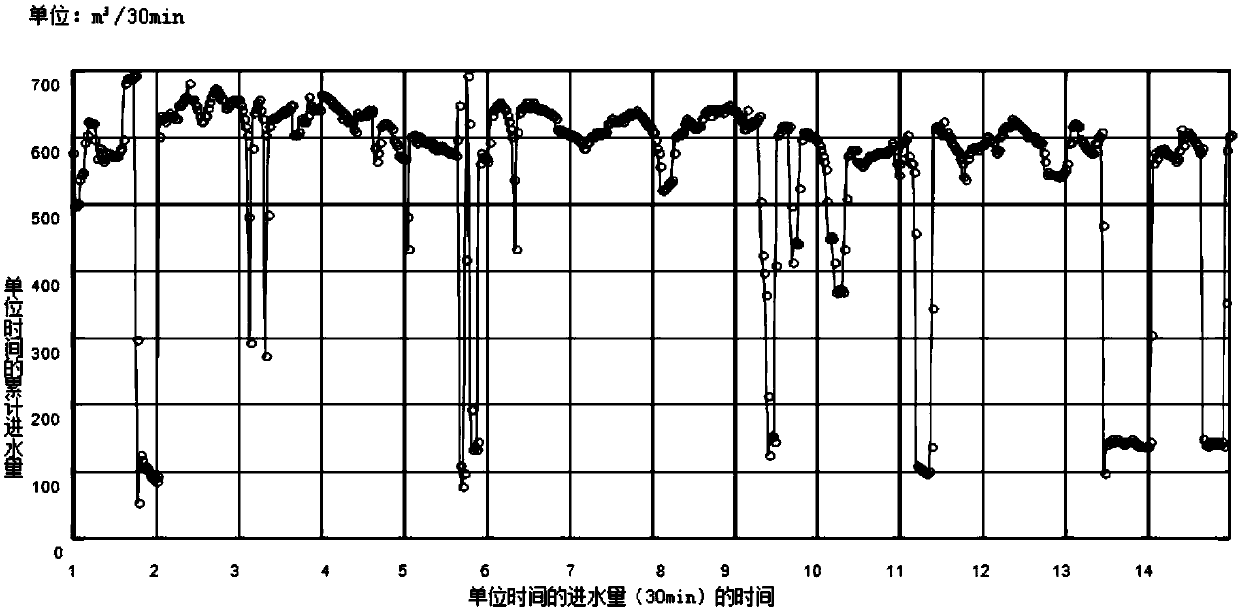

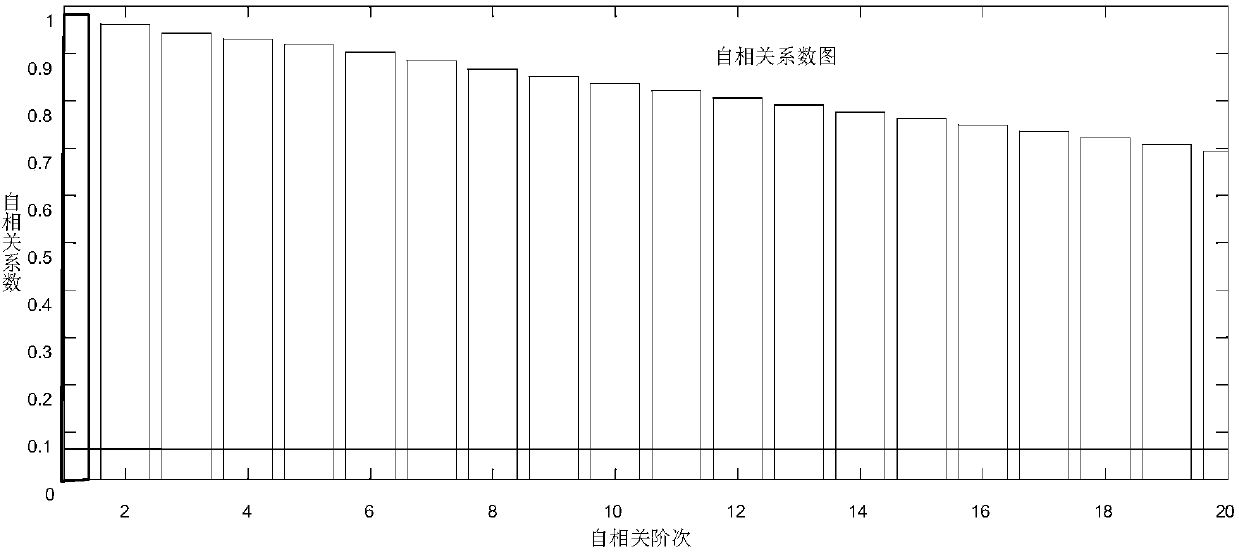

Method for predicting industrial sewage inflow based on ARIMA model

InactiveCN108564229AGood forecastWill not affect the prediction accuracyEnergy industryForecastingMoving averageAlgorithm

The invention discloses a method for predicting industrial sewage inflow based on an ARIMA model. The method comprises the following steps: analyzing initial time series data to meet a requirement onARIMA model establishment; preprocessing abnormal data by eliminating, filling and the like; removing data noise through moving average filtering; by a unit root testing method, performing ADF testingon the stability of a time series; analyzing and verifying the non-randomness through an autocorrelation coefficient; preliminarily determinating an autoregressive and moving average order of the ARIMA (p, d, q) model, and then performing order determination on the model through combination with an AIC information criterion; optimizing model parameters by a least squares method; finally, testinga residual and evaluating a simulation result to determine a final prediction model. Acquired sewage inflow data are determined, and the obtained prediction model is used for predicting test data, andan output of the model is a prediction result of the sewage inflow. By the method, the model is succinct, the fitting effect of the prediction model is very good, and the precision is high.

Owner:广东省广业检验检测集团有限公司

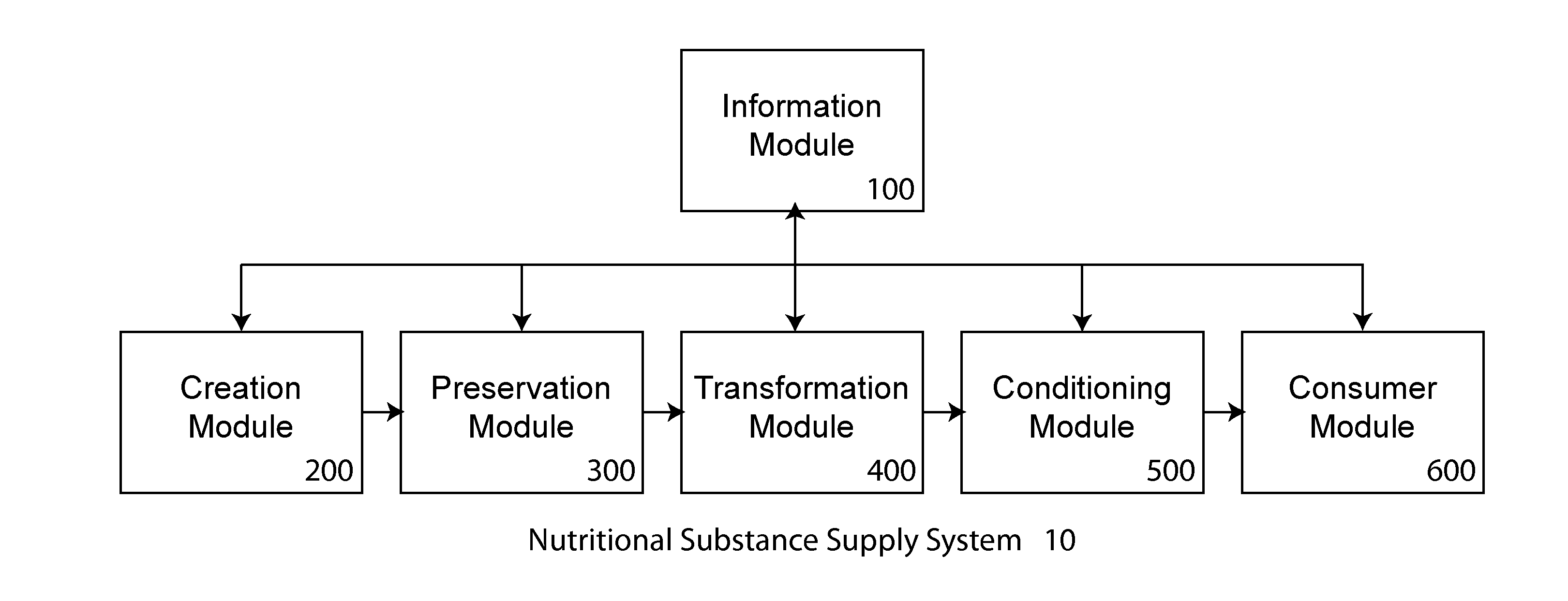

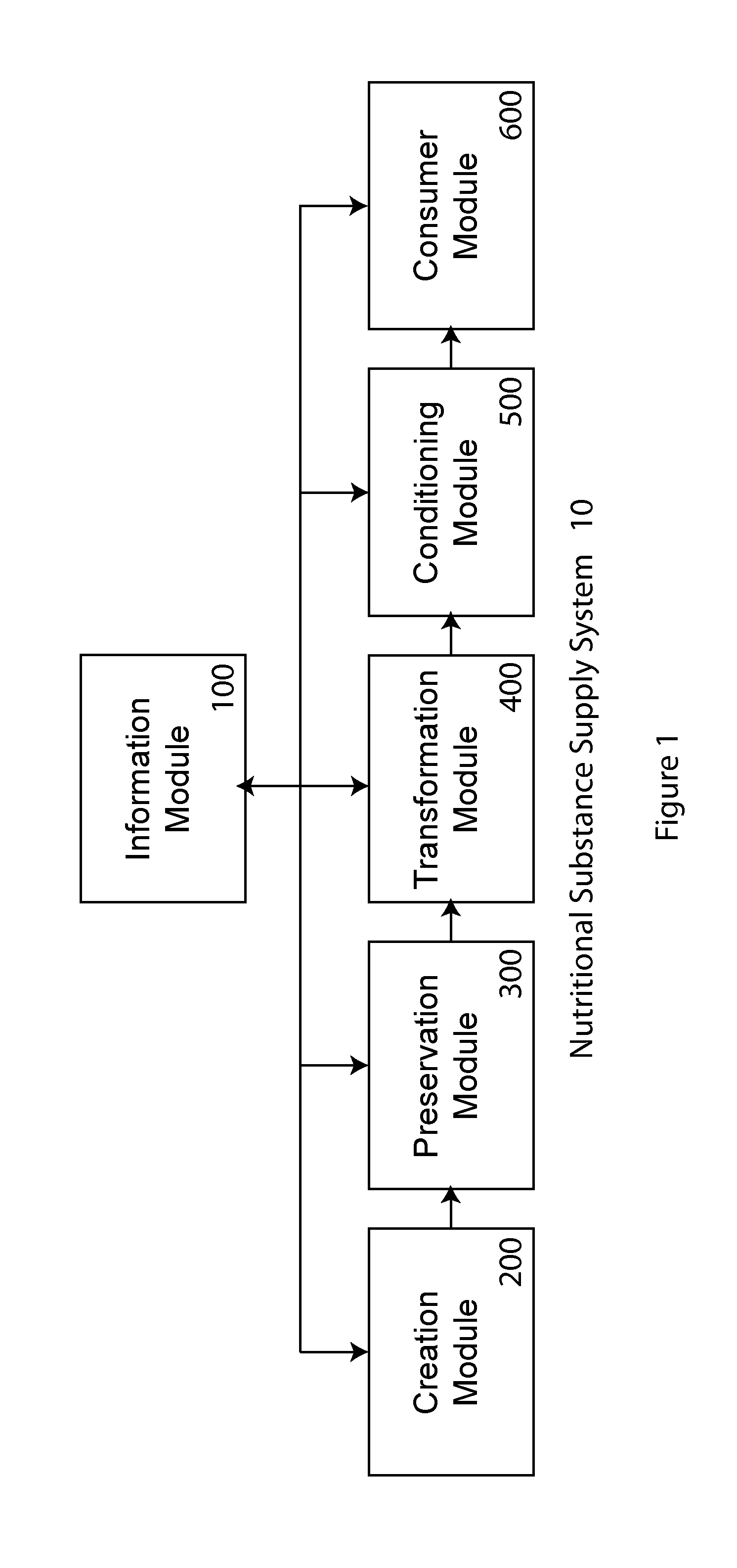

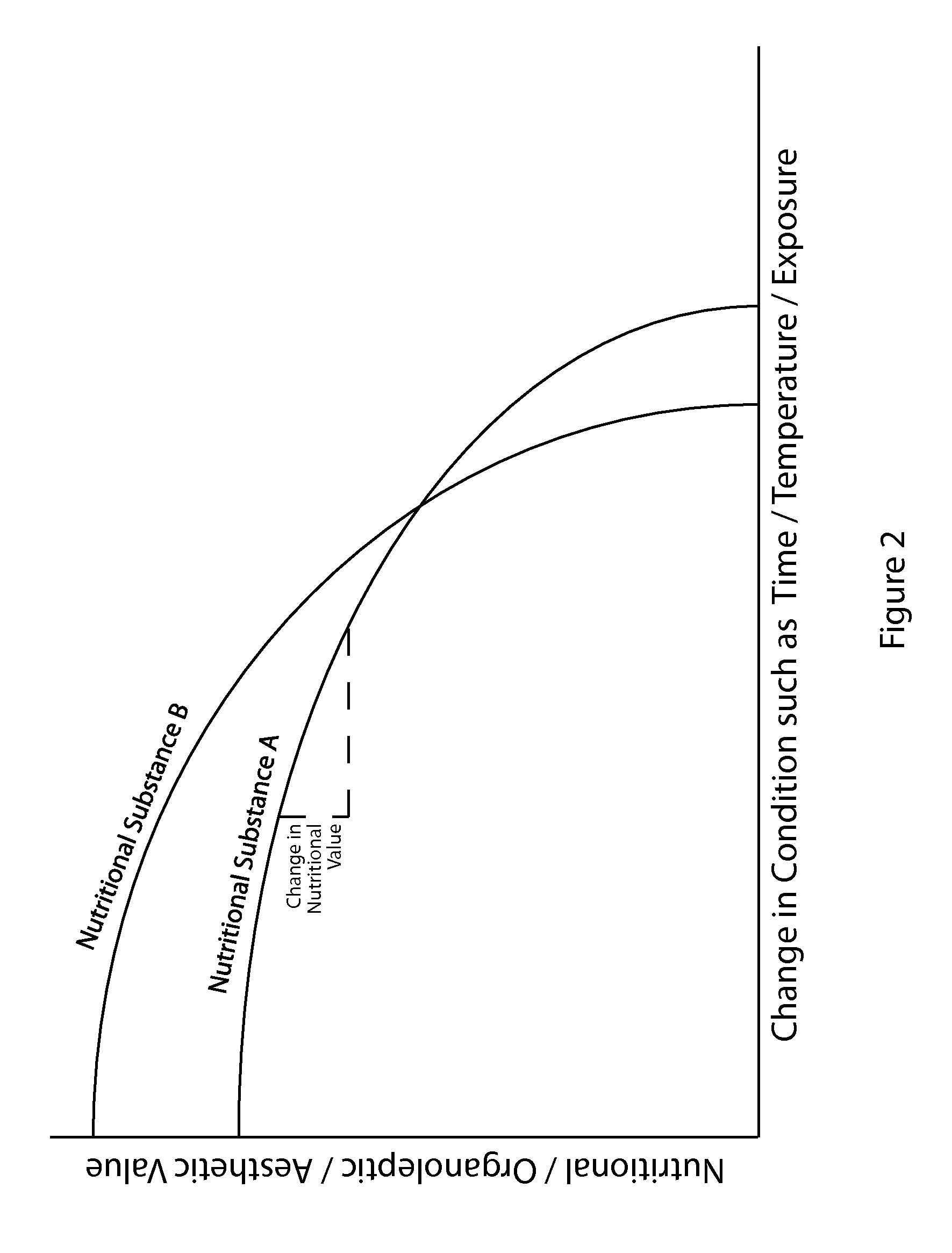

Information system for nutritional substances

InactiveUS20130275342A1Preserve and enhances nutritional value and taste of nutritionalImprove abilitiesDigital data processing detailsCommerceBiologyInformation system

Disclosed herein is a information system for nutritional substances. The information system obtains information regarding a nutritional substance from the creation of the nutritional substance, the preservation of the nutritional substance, the transformation of the nutritional substance, the conditioning of the nutritional substance, and the consumption of the nutritional substances. The information system stores and provides this information to the various constituents of the nutritional substance supply system.

Owner:ICEBERG LUXEMBOURG S A R L

Biological pesticidal organic fertilizer

InactiveCN102816014AImproved soilProtect the original ecological environmentBio-organic fraction processingOrganic fertiliser preparationChemistryMagnesium sulphate heptahydrate

The invention discloses a biological pesticidal organic fertilizer which is prepared from the following components in a certain weight ratio: rapeseed meal, waste tobacco materials, wood chips, garlic stem, paulownia sawdust, Celastrus angulatus, patrinia, livestock and poultry manures, a biological bacterial preparation, zinc sulfate, magnesium sulfate, sodium molybdate and borax. The fertilizer prepared in the invention greatly reduces utilization amount of organic pesticides and fertilizers, is prepared from natural pure plant Chinese herbal medicines, poses no pollution to the environment and crops, has an effect on improving soil, is both a fertilizer for crops and a pesticide, can protect the original ecological environment and benefit the mankind, and represents general course of future agricultural development.

Owner:安徽金农生态农业科技发展有限公司

Biological pesticidal organic fertilizer

InactiveCN102786362AReduce usageImproveBio-organic fraction processingOrganic fertiliser preparationPaulowniaEcological environment

The invention discloses a biological pesticidal organic fertilizer which is prepared from the following components in a certain weight ratio: rapeseed meal, dregs of traditional Chinese medicines, bamboo sawdust, slow-release potassium chloride, paulownia sawdust, Celastrus angulatus, patrinia, cow and sheep manures, nitrogen-phosphorus-potassium compound fertilizer, biological bacteria, zinc sulfate, magnesium sulfate, sodium molybdate and borax. The fertilizer prepared in the invention greatly reduces utilization amount of organic pesticides and fertilizers, is prepared from natural pure plant Chinese herbal medicines, poses no pollution to the environment and crops, has an effect on improving soil, is both a fertilizer for crops and a pesticide, can protect the original ecological environment and benefit the mankind, and represents general course of future agricultural development.

Owner:安徽金农生态农业科技发展有限公司

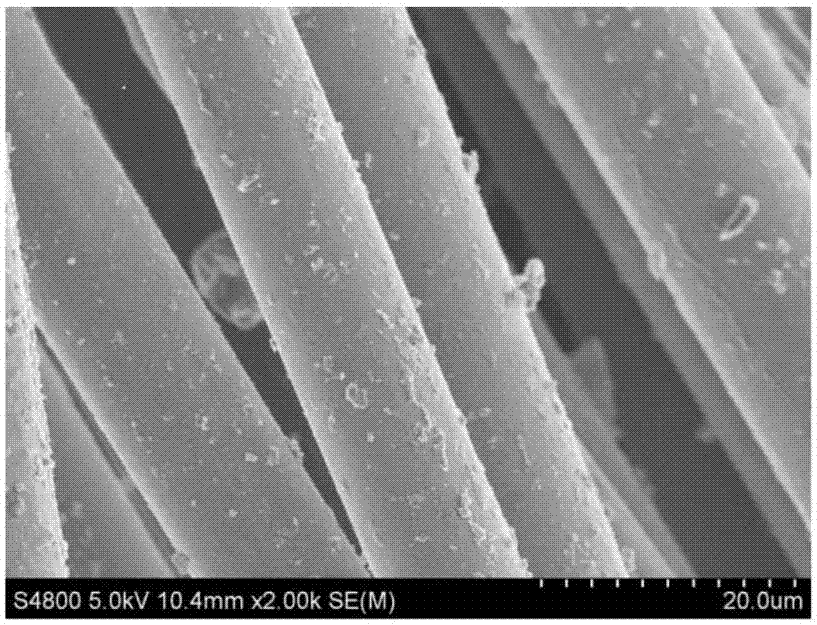

SiC nanowire in-situ enhanced SiCf/SiC composite material and preparation method of SiC nanowire in-situ enhanced SiCf/SiC composite material

The invention discloses a SiC nanowire in-situ enhanced SiCf / SiC composite material and a preparation method of the SiC nanowire in-situ enhanced SiCf / SiC composite material. The composite material is prepared from a SiC fiber prefabricated part, SiC nanowires and a SiC ceramic matrix, wherein the SiC nanowires grow on a fiber surface of the SiC fiber prefabricated part in situ; the SiC nanowires are mutually wound to form a net-shaped structure; the SiC ceramic matrix is arranged in a pore of the SiC fiber prefabricated part. The preparation method comprises the following steps: (1) carrying out surface chemical modification treatment; (2) loading a catalyst; (3) carrying out chemical vapor deposition; (4) impregnating a precursor and cracking. The SiC nanowire in-situ enhanced SiCf / SiC composite material provided by the invention has the advantages that the SiC nanowires are uniformly distributed and are combined with SiC fibers well, the toughness is good and the density is high and the like; the preparation method is simple in process, low in requirements on equipment, environmental-friendly, and good in process commonality; the introduction volume fraction of the SiC nanowires is high and is controllable.

Owner:NAT UNIV OF DEFENSE TECH

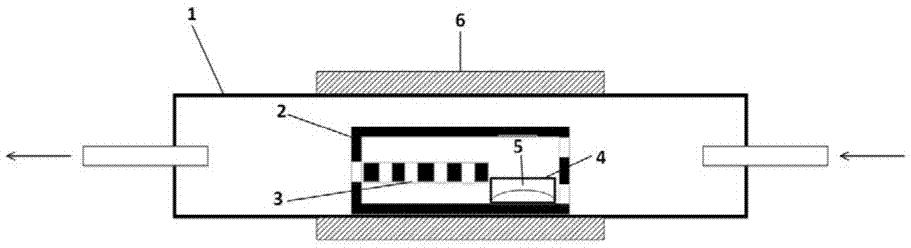

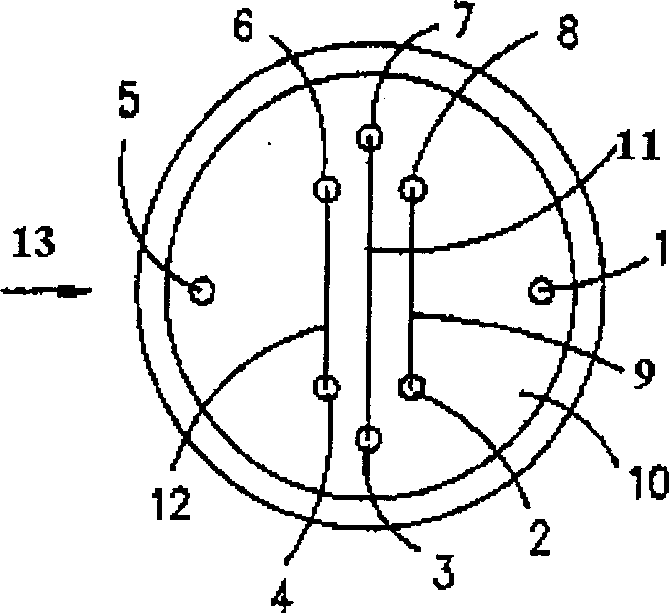

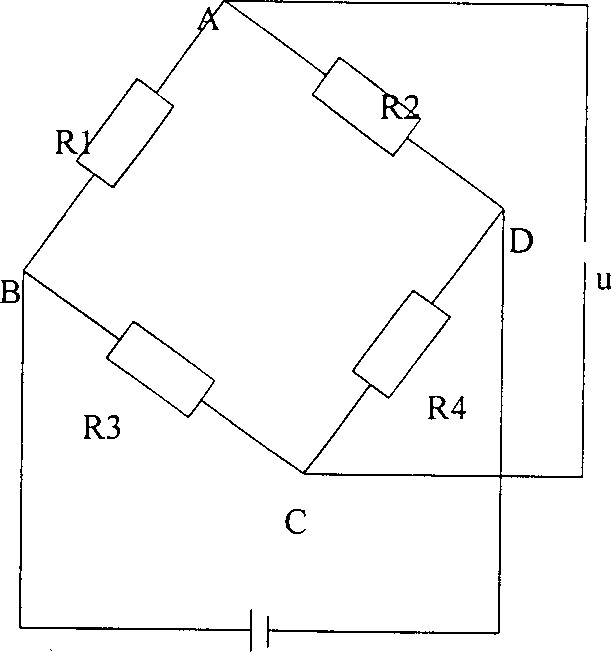

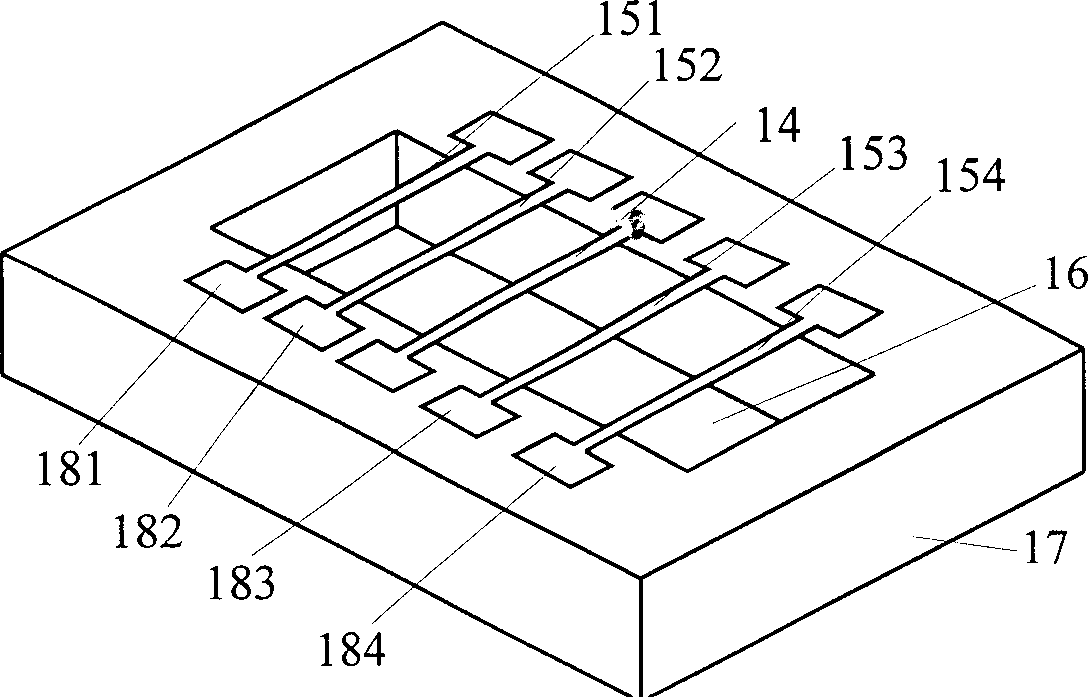

Miniature silicon dridge type heat convection acceleration sensor

A miniature silicon bridge type acceleration sensor based on heat convection principle is composed of a sealed cavity, a heating wire in the center of said cavity, two pairs of temp sensors symmetricabout said heating wire and bridge-type temp measuring circuit composed of said temp sensors. Its advantages are high range and impact resistance, small size, low cost, and high linearity, sensitivity and response frequency.

Owner:TSINGHUA UNIV

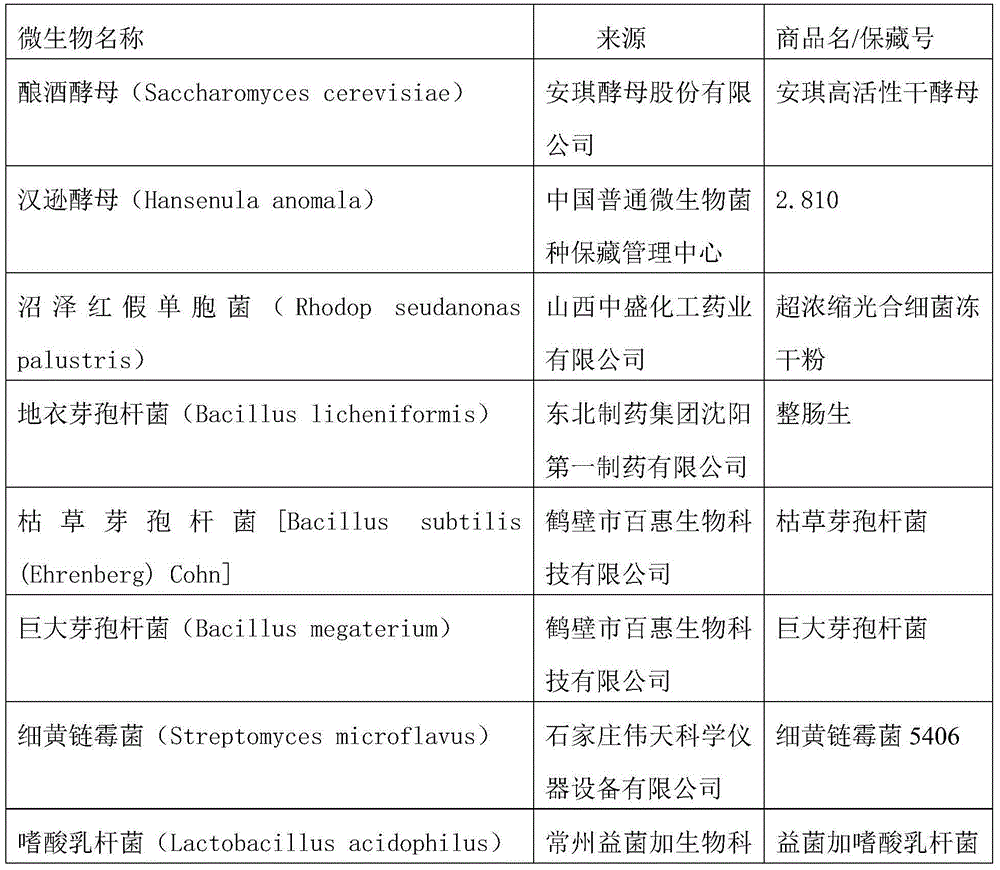

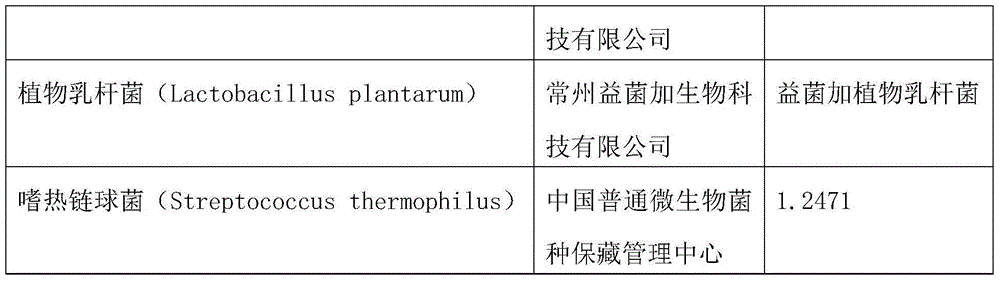

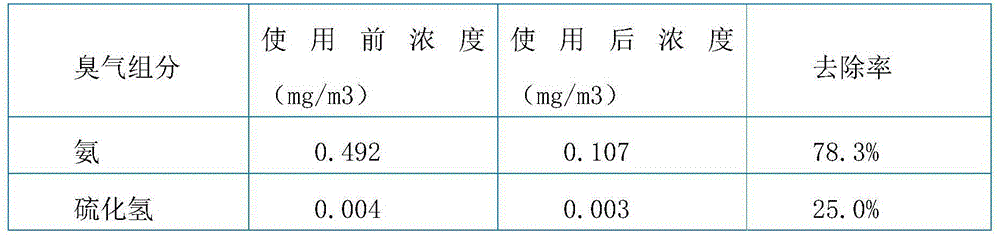

Microbial preparation for purifying sewage and deodorizing garbage and preparation method thereof

The invention provides a microbial preparation for purifying sewage and deodorizing garbage. The microbial preparation is a liquid culture which comprises the following microorganisms: saccharomyces cerevisiae, hansenula polymorpha, rhodopseudomonas palustris, bacillus licheniformis, bacillus subtilis, bacillus megaterium, streptomyces microflavus, lactobacillus acidophilus, lactobacillus plantarum and streptococcus thermophilus. A liquid culturing medium comprises molasses, sodium chloride and urea. The number of viable bacteria in the microbial preparation is more than 1*1010cfu / ml. The microbial preparation can be added into the sewage or sprayed into a garbage transfer station, a garbage landfill and a farm to improve the environment significantly.

Owner:上海寄绿生物环保科技有限公司

Nutritional type high slow release performance compound fertilizer for planting rice and preparation method thereof

InactiveCN106748032AGood sustained release effectImprove absorption and utilizationCalcareous fertilisersBio-organic fraction processingChemistryHumic acid

The invention discloses a nutritional type high slow release performance compound fertilizer for planting rice. The nutritional type high slow release performance compound fertilizer comprises the raw materials of urea, monoammonium phosphate, potassium chloride, ammonium chloride, diammonium hydrogen phosphate, monocalcium phosphate, zinc sulfate, ammonium molybdate, magnesium sulfate, oyster shell powder, kieselguhr, modified sepiolite powder, kaolin powder, talcum powder, dolomite powder, zeolite powder, thiourea, dicyandiamide, chicken manure, cicada manure, wormcast, maize straw, rapeseed cake, bagasse, coal ash, perilla seed, humic acid, EM strain, lignin and a modified slow-release inhibitor. The invention further provides a preparation method of the nutritional type high slow release performance compound fertilizer. The prepared compound fertilizer has an excellent slow release performance, provides rich nutrient substances for the crop, promotes the growth of the crop, and improves the yield and the quality of the crop.

Owner:安徽爱能洁生物科技有限公司

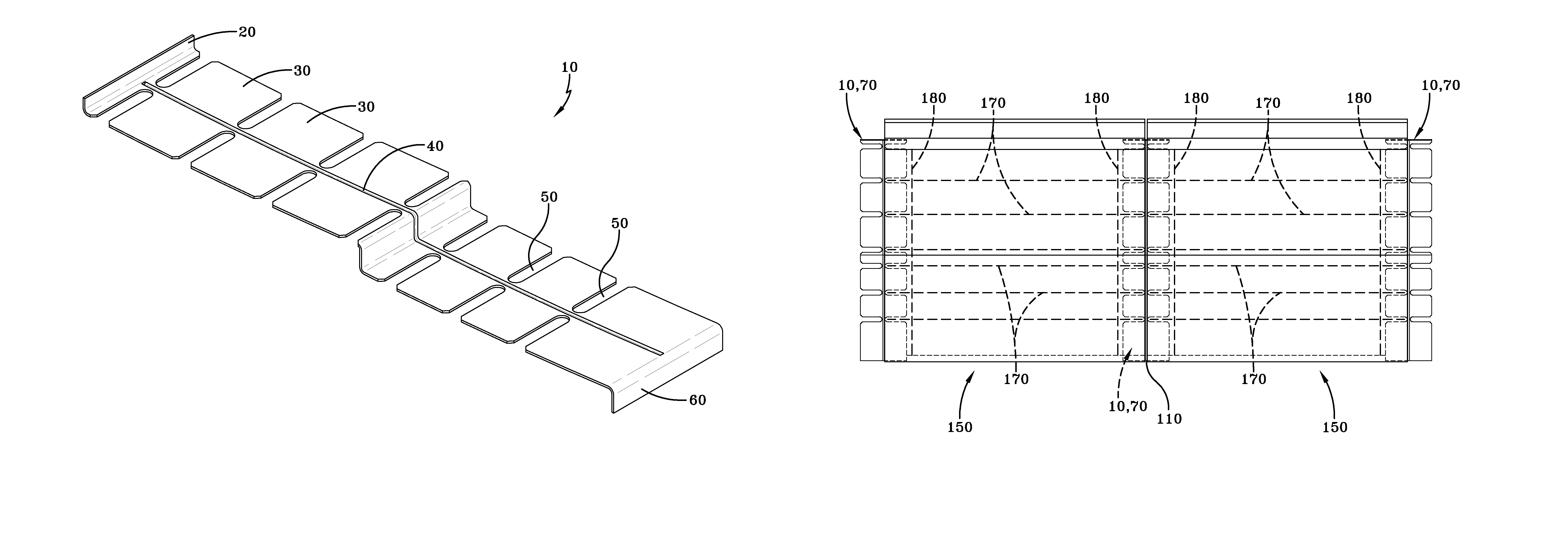

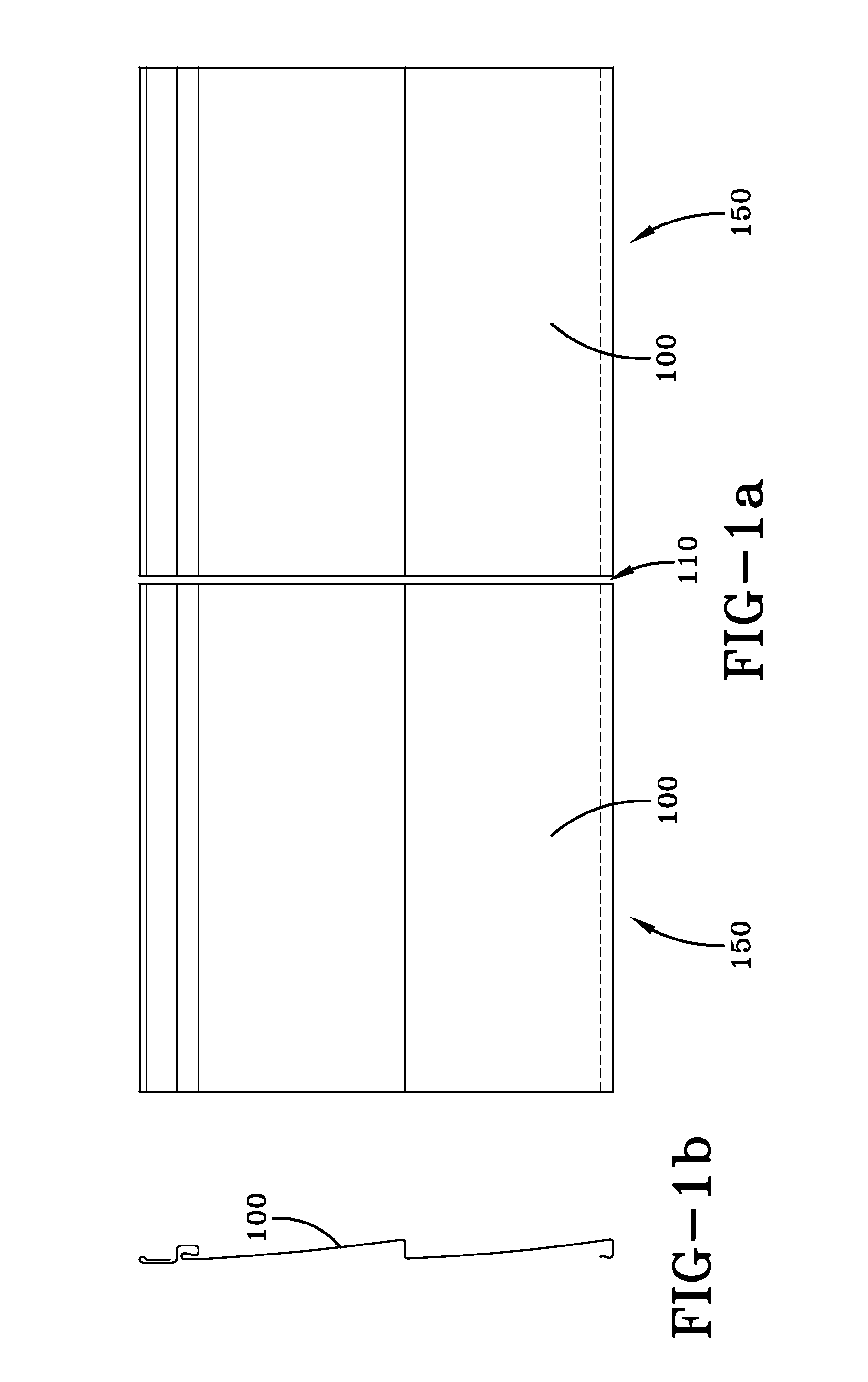

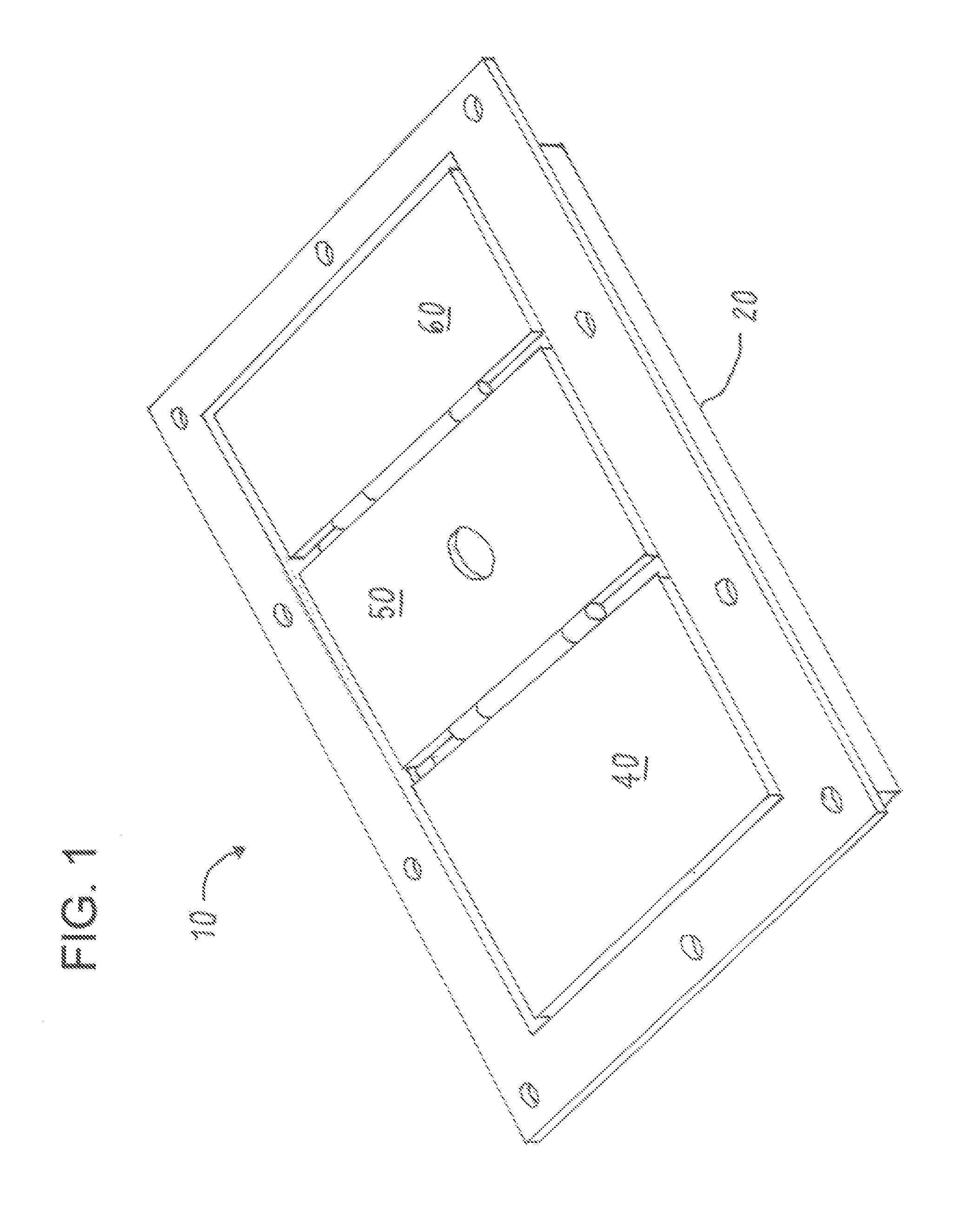

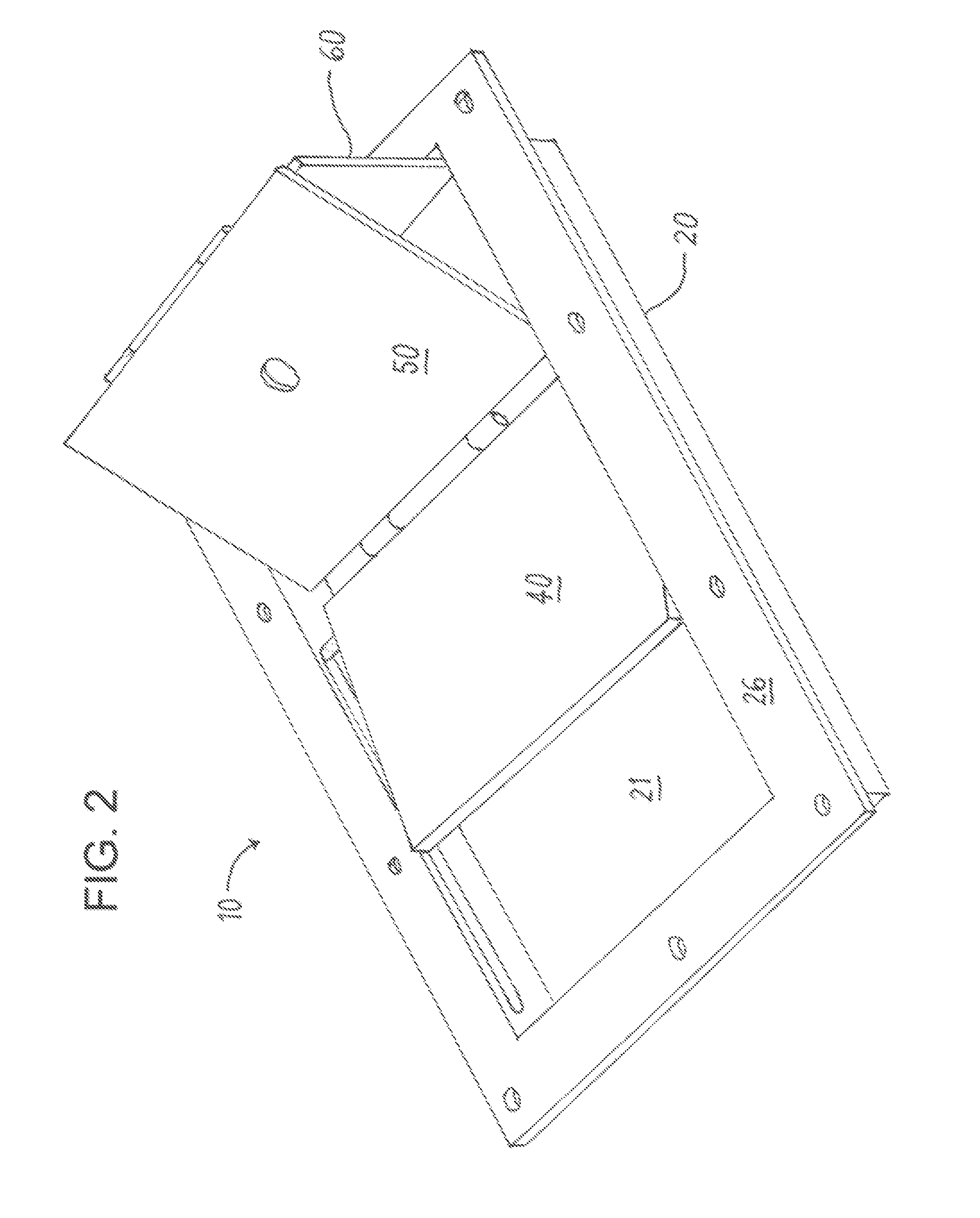

System and method for leveling or alignment of panels

ActiveUS7685787B1ImprovePlease appearanceRoof covering using tiles/slatesCovering/liningsLap jointEngineering

A system for connecting and sealing panels comprising a bridge component with elevated and recessed surface features adapted to receive and bridge adjacent panels to form a weather-resistant seal and aesthetically pleasing appearance. By providing mating surface features to receive a side edge portion of an adjacent panel assembly, an exemplary embodiment of the present invention may enable an improved lap joint to be established between adjacent backed panels.

Owner:WESTLAKE ROYAL BUILDING PROD (USA) INC

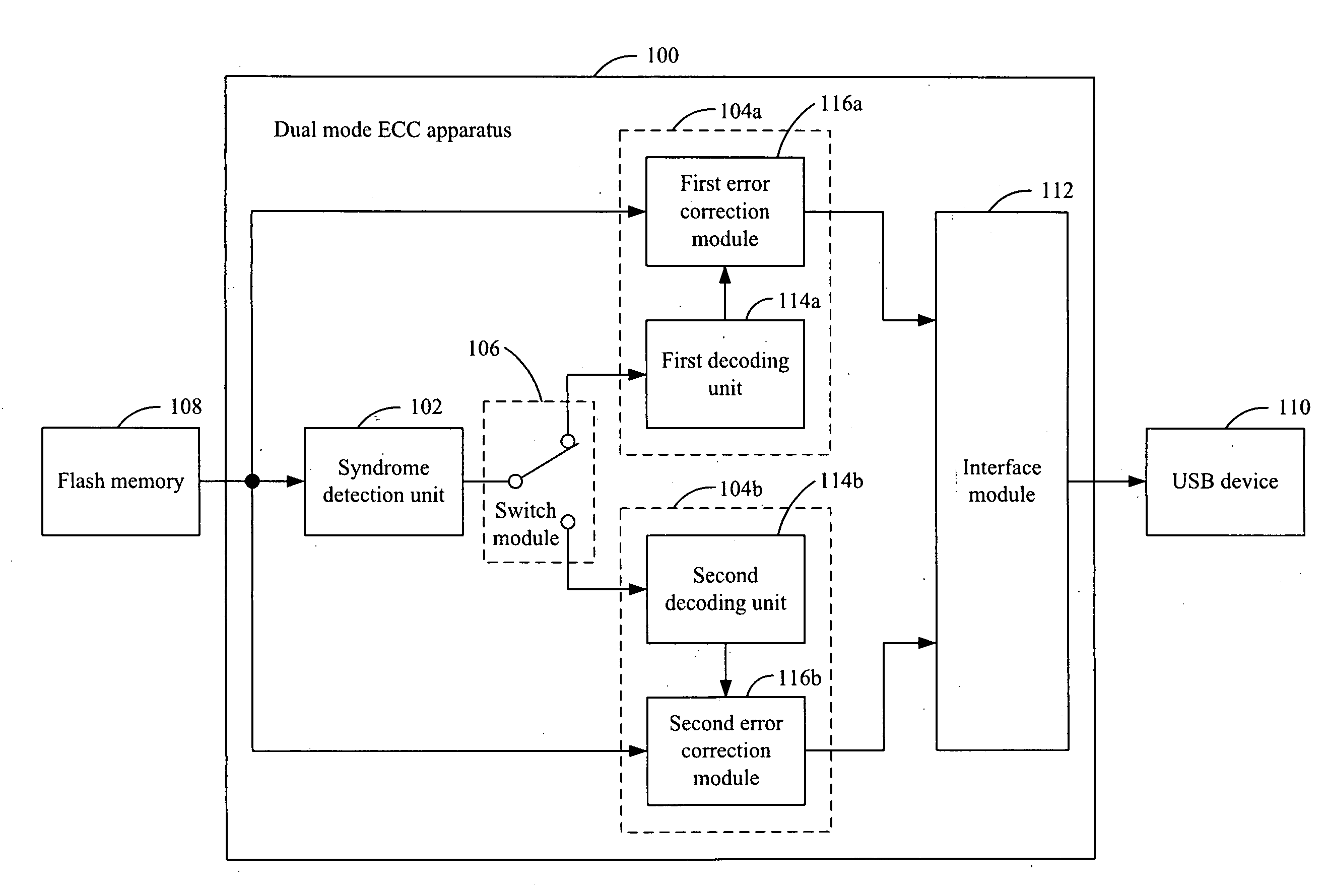

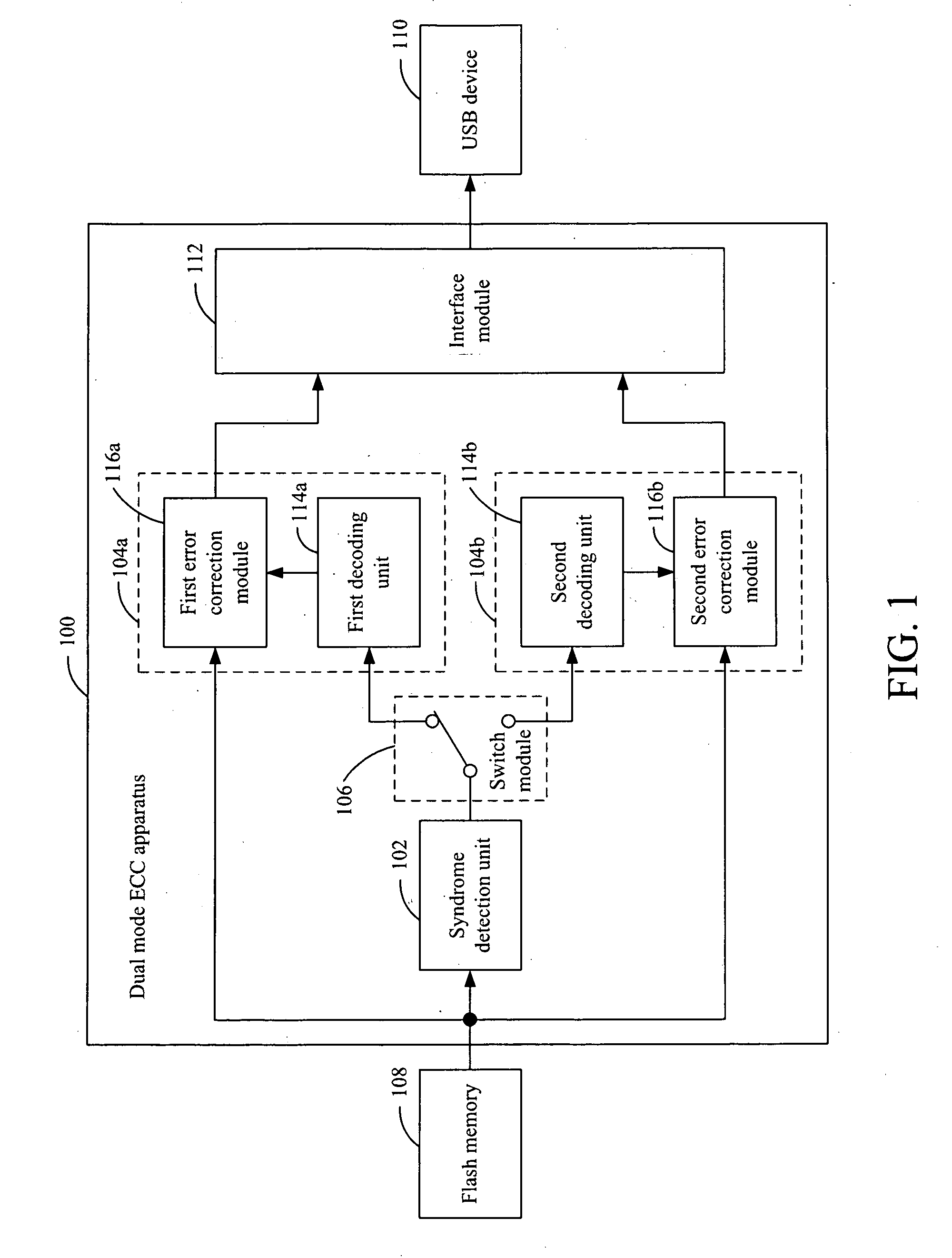

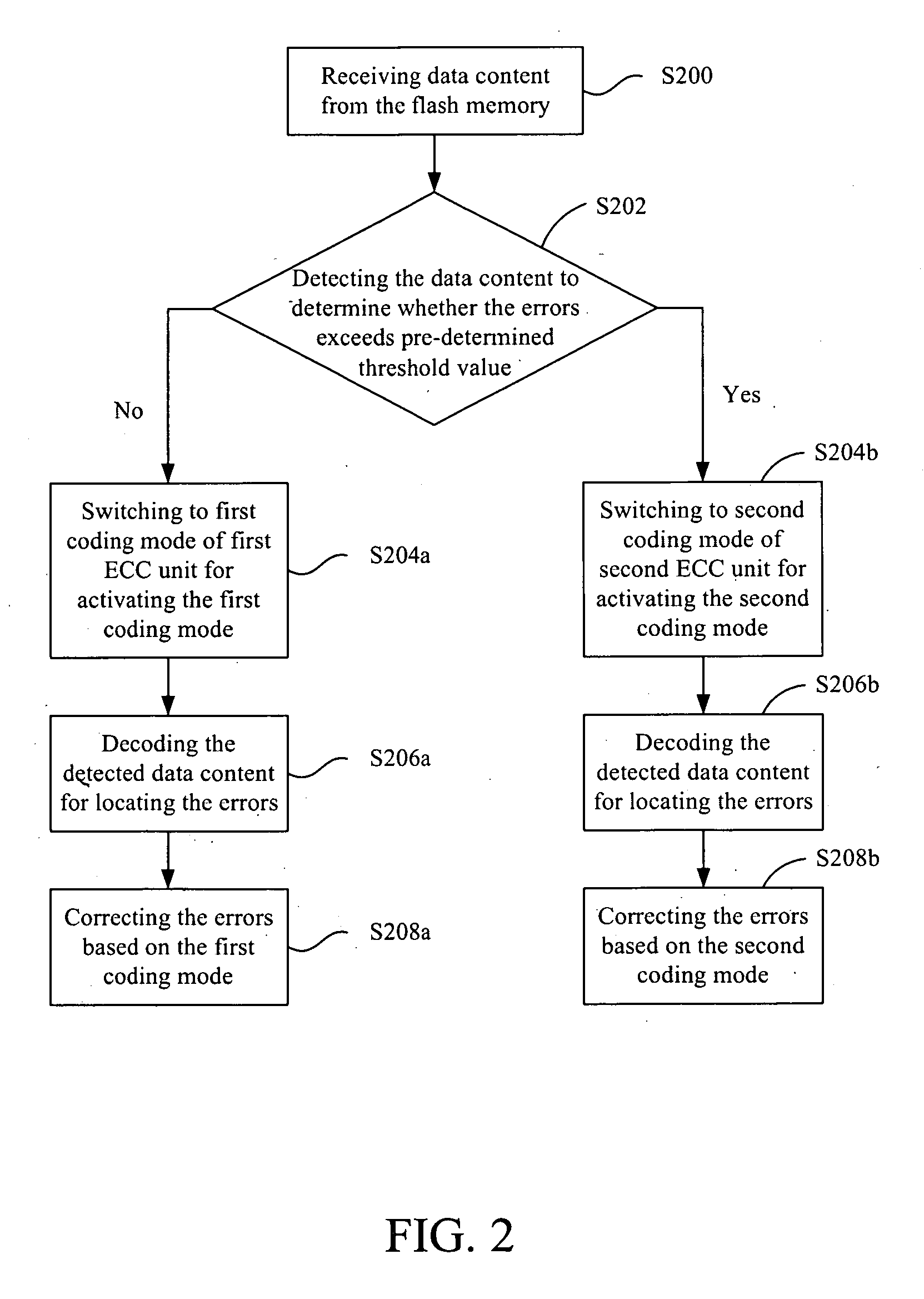

Dual mode error correction code (ECC) apparatus for flash memory and method thereof

InactiveUS20100100797A1ImproveImprove the flash memory controllerCode conversionCyclic codesData contentFlash memory

A dual mode error correction code (ECC) apparatus for the flash memory and method thereof are described. The dual mode error correction code (ECC) apparatus includes a syndrome detection unit, a first ECC unit, a second ECC unit, a switch module, and an interface module. The syndrome detection unit detects the data content for computing the amount of errors in the data content to determine whether the amount of the errors exceeds a pre-determined threshold value. The first ECC unit corrects the errors in the data content based on a first coding mode. The second ECC unit corrects the errors in the data content based on a second coding mode. The switch module either switches to the first ECC unit for activating the first coding mode of the first ECC unit if the amount of the errors is fewer than a pre-determined threshold value or switches to the second ECC unit for activating the second coding mode of the second ECC unit if the amount of the errors is greater than the pre-determined threshold value.

Owner:GENESYS LOGIC INC

Phytonutrient nutritional supplement

A composition and method for correcting a dietary phytonutrient deficiency. The composition includes one or more of the following phytonutrients: lutein, lycopene, epigallocatechin gallate (EGCG), ellagic acid, hesperidin and quercetin. Dietary phytonutrient deficiencies are corrected by administration of these phytonutrients in amounts equal or greater than the amounts of these phytonutrients present in recommended daily servings of fruits and vegetables.

Owner:ACCESS BUSINESS GRP INT LLC

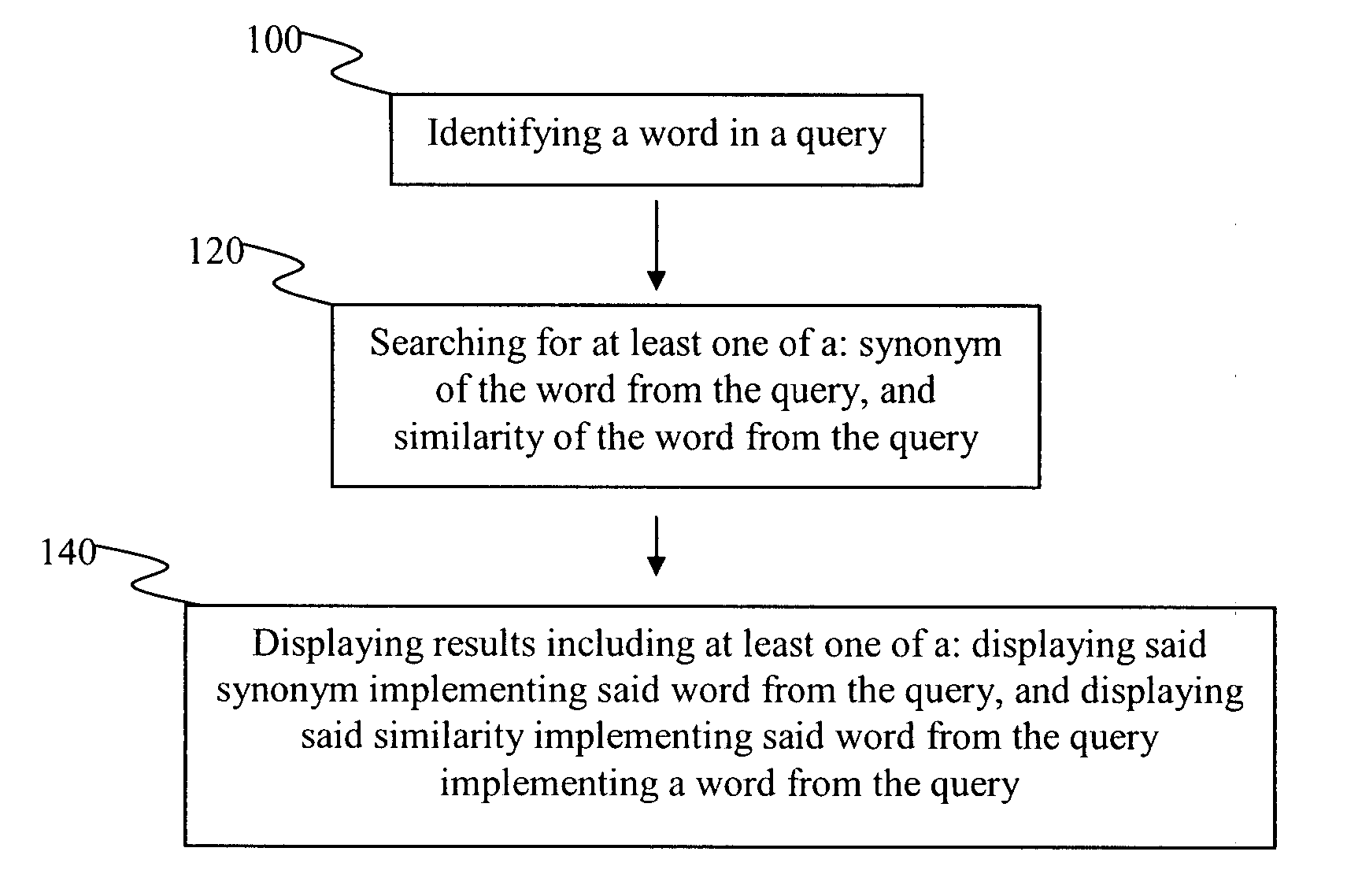

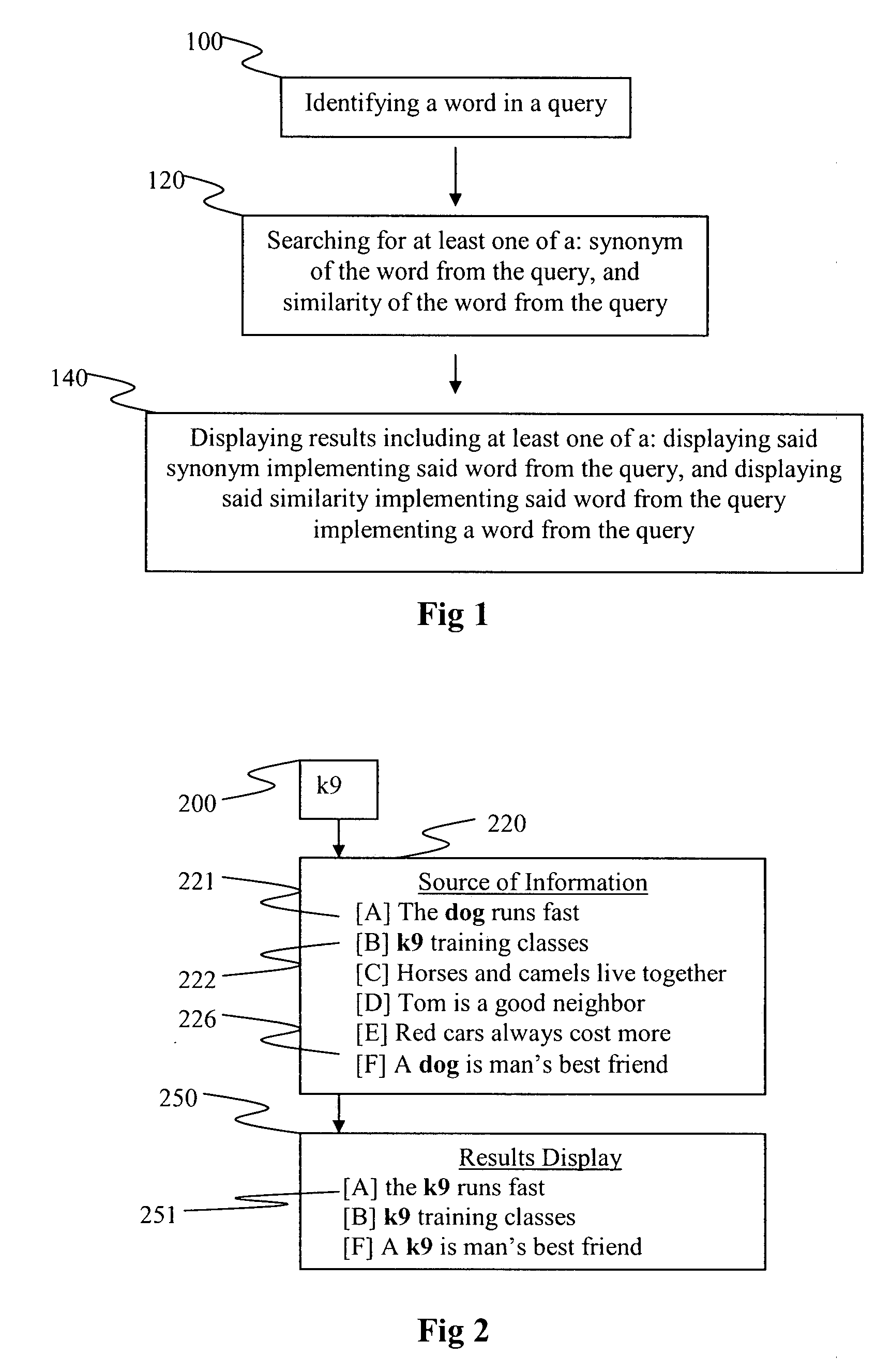

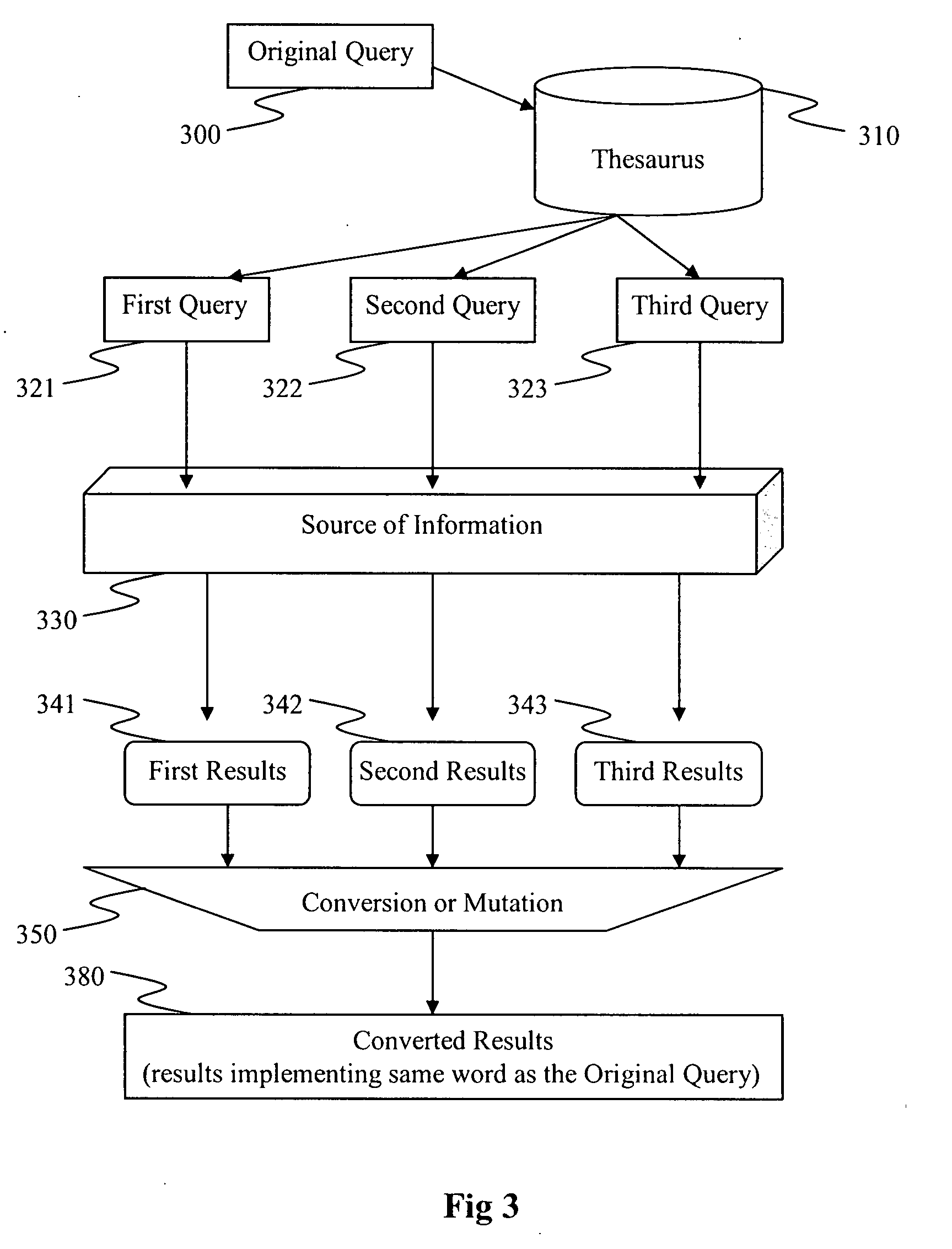

Methods for providing, displaying and suggesting results involving synonyms, similarities and others

InactiveUS20080082511A1ImproveDigital data information retrievalSpecial data processing applicationsSynonymSpoken Language Ability

Owner:WILLIAMS JOHN WILLIAMS

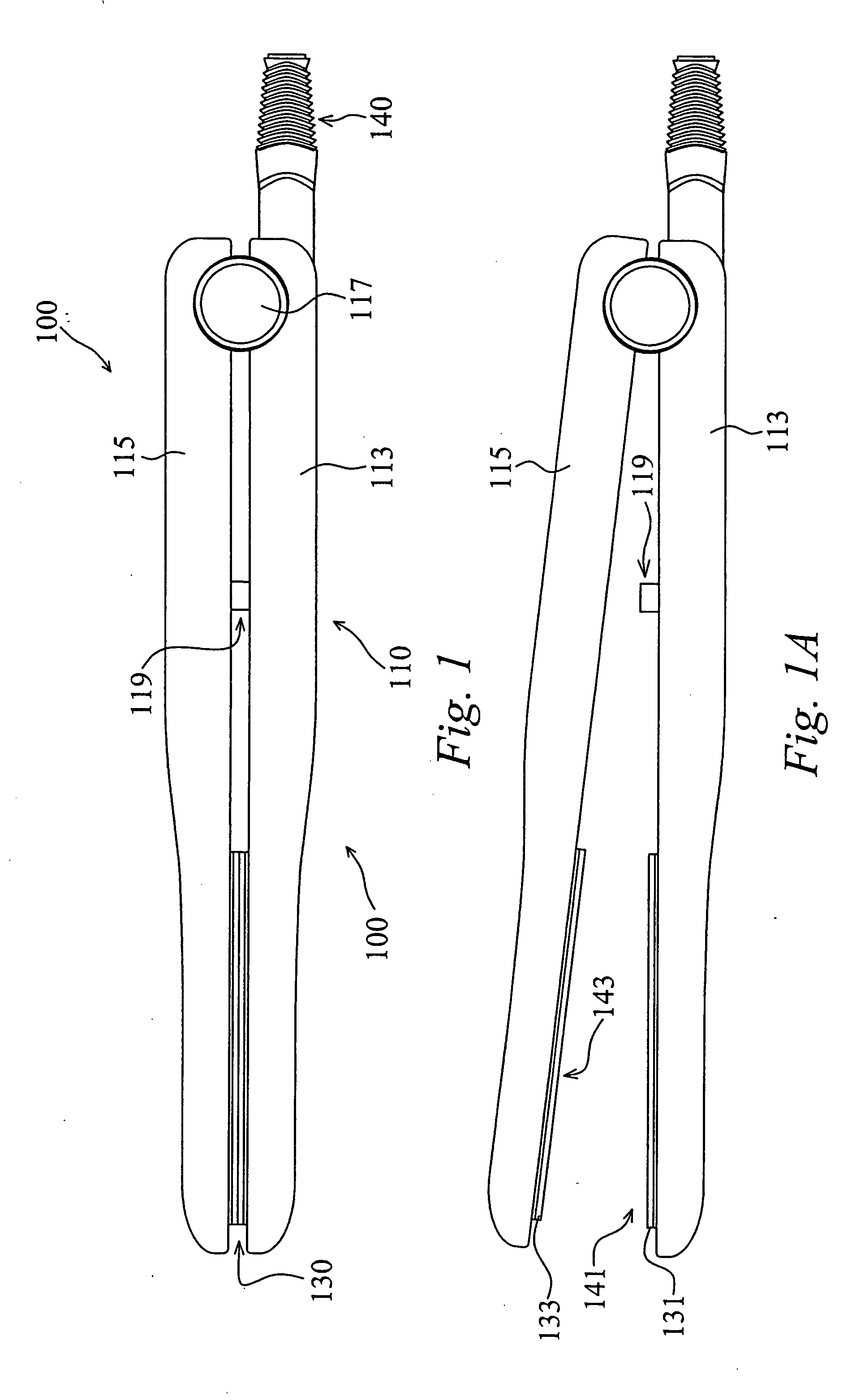

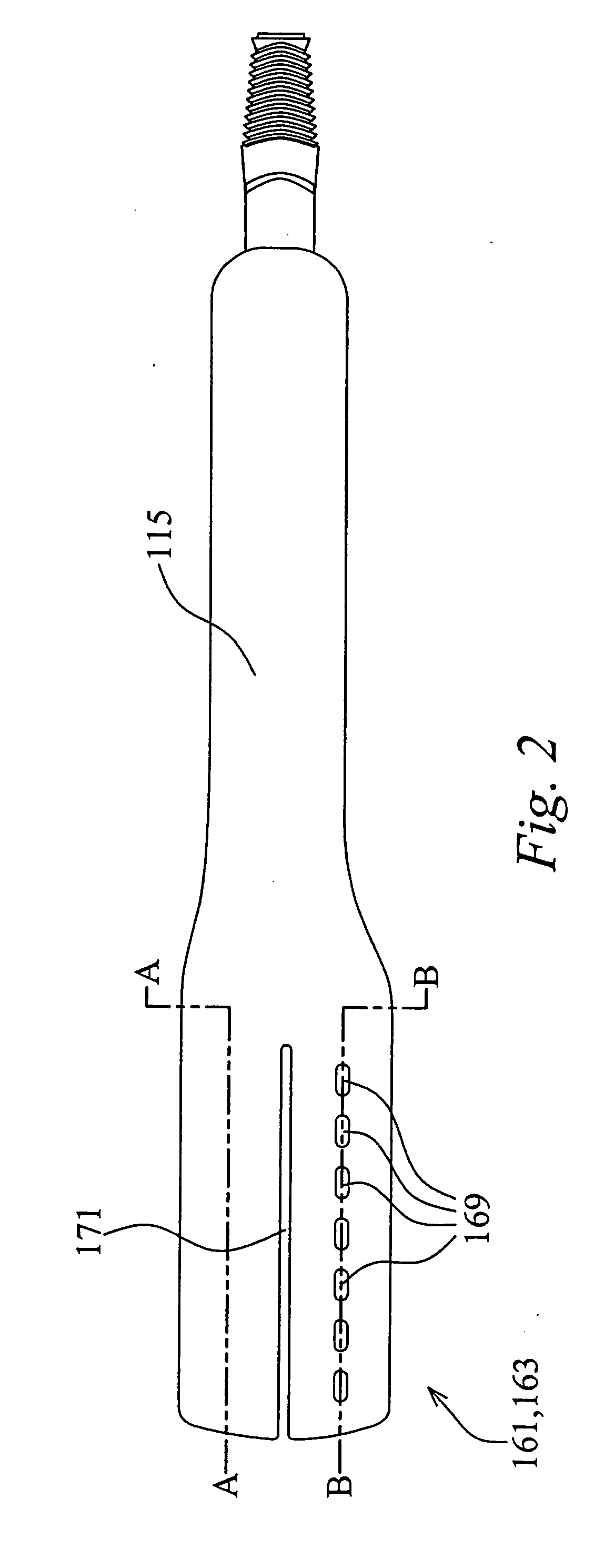

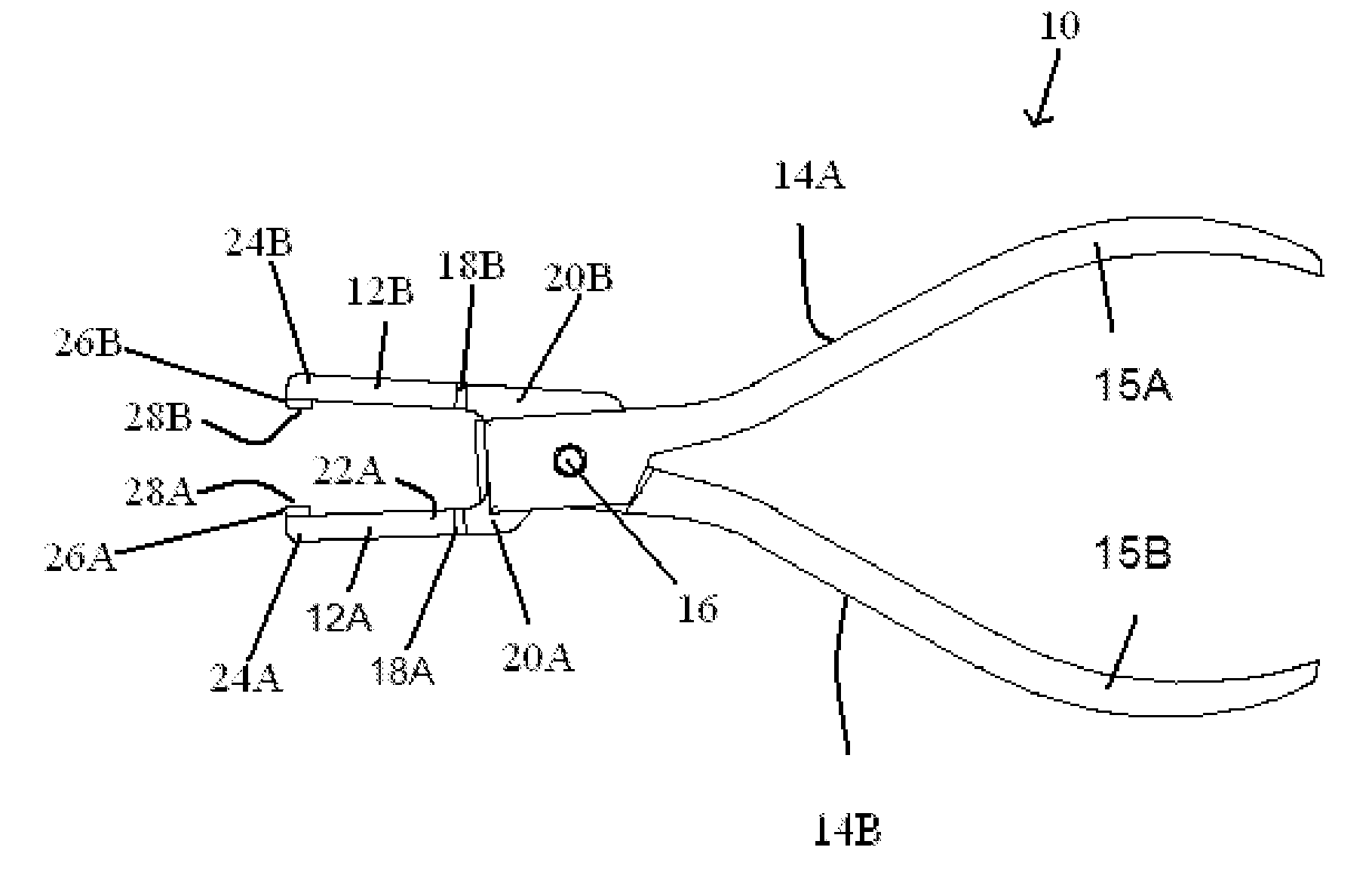

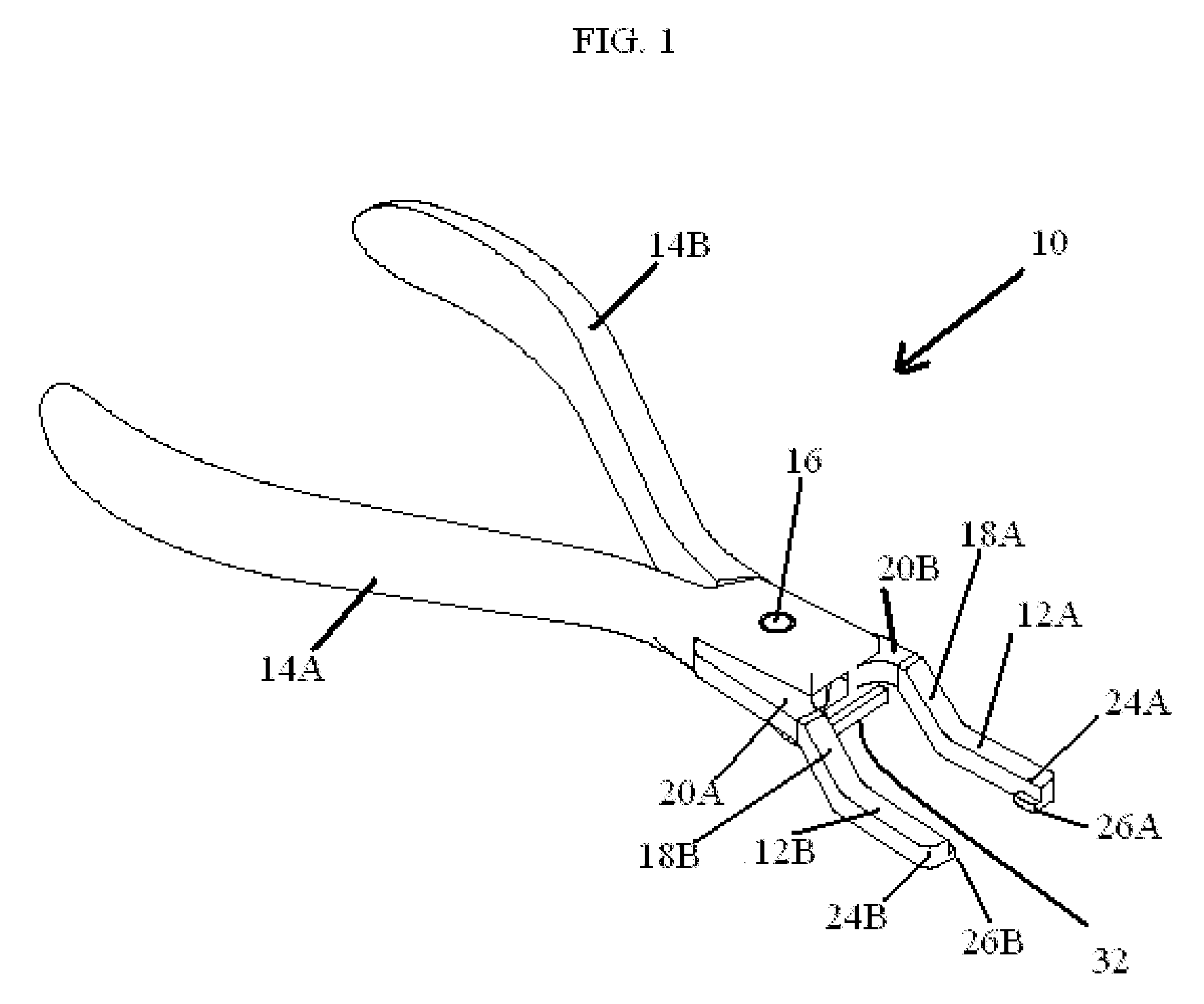

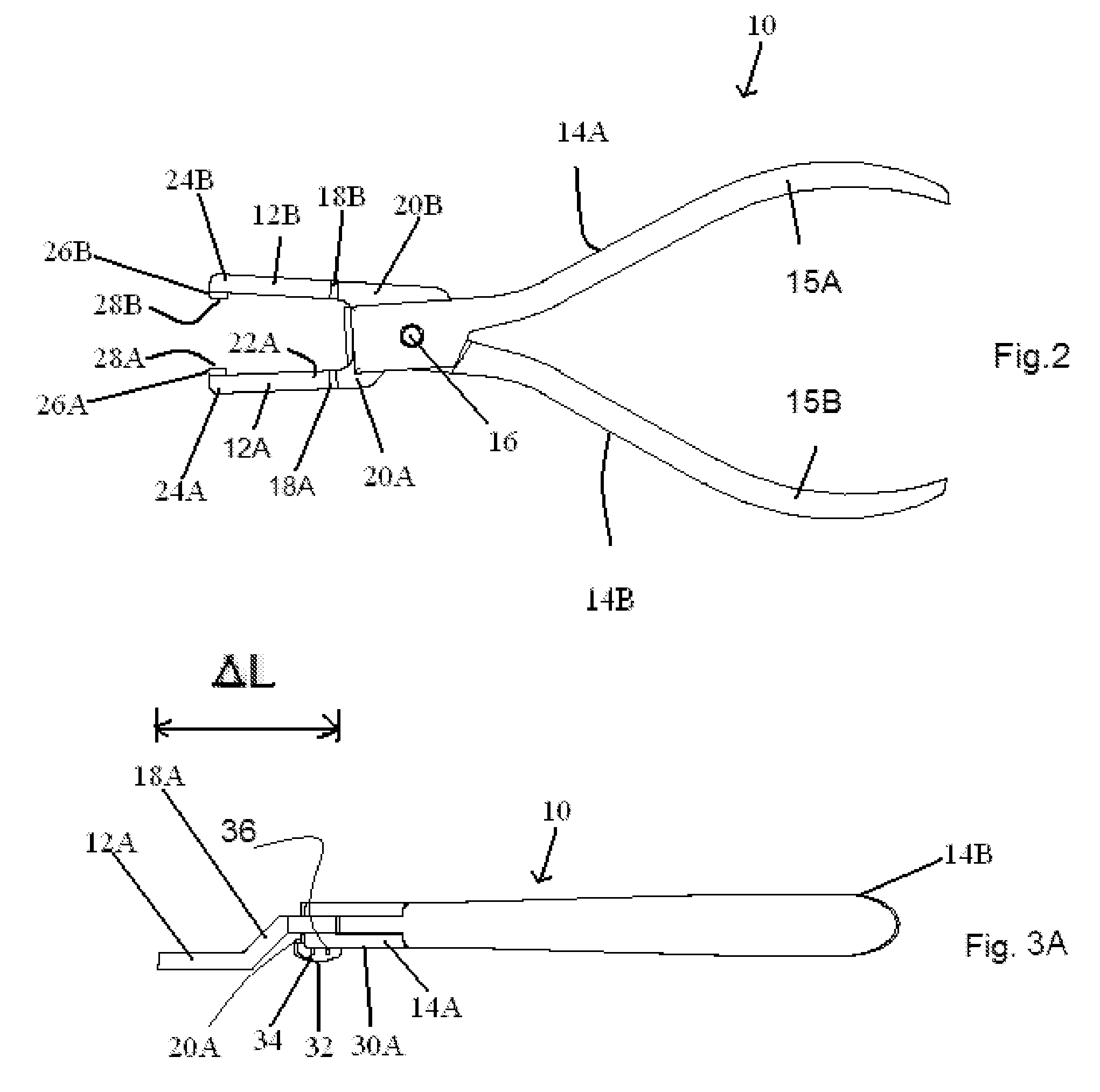

Dental pliers

Owner:GOODMAN PHILLIP MARSHALL

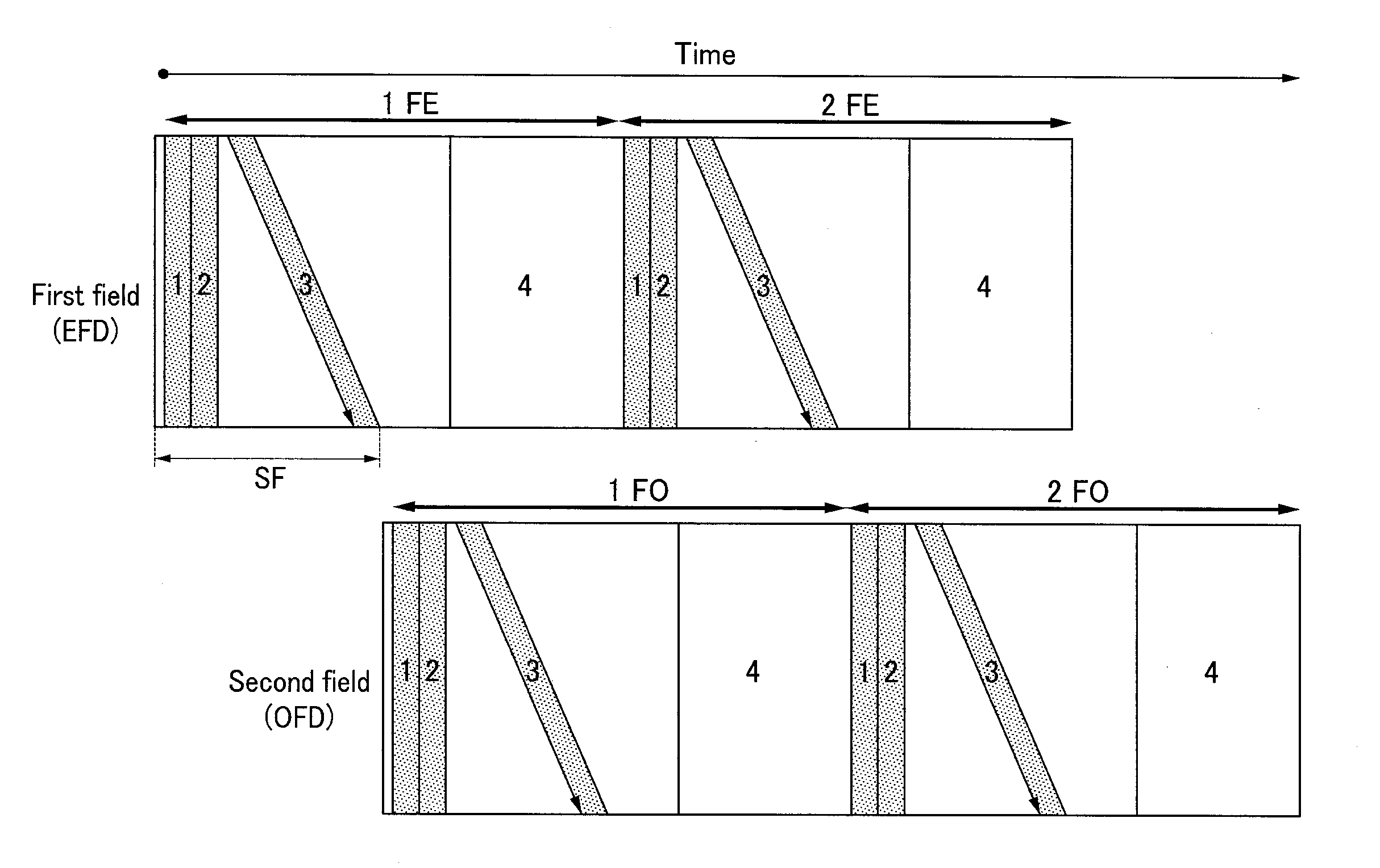

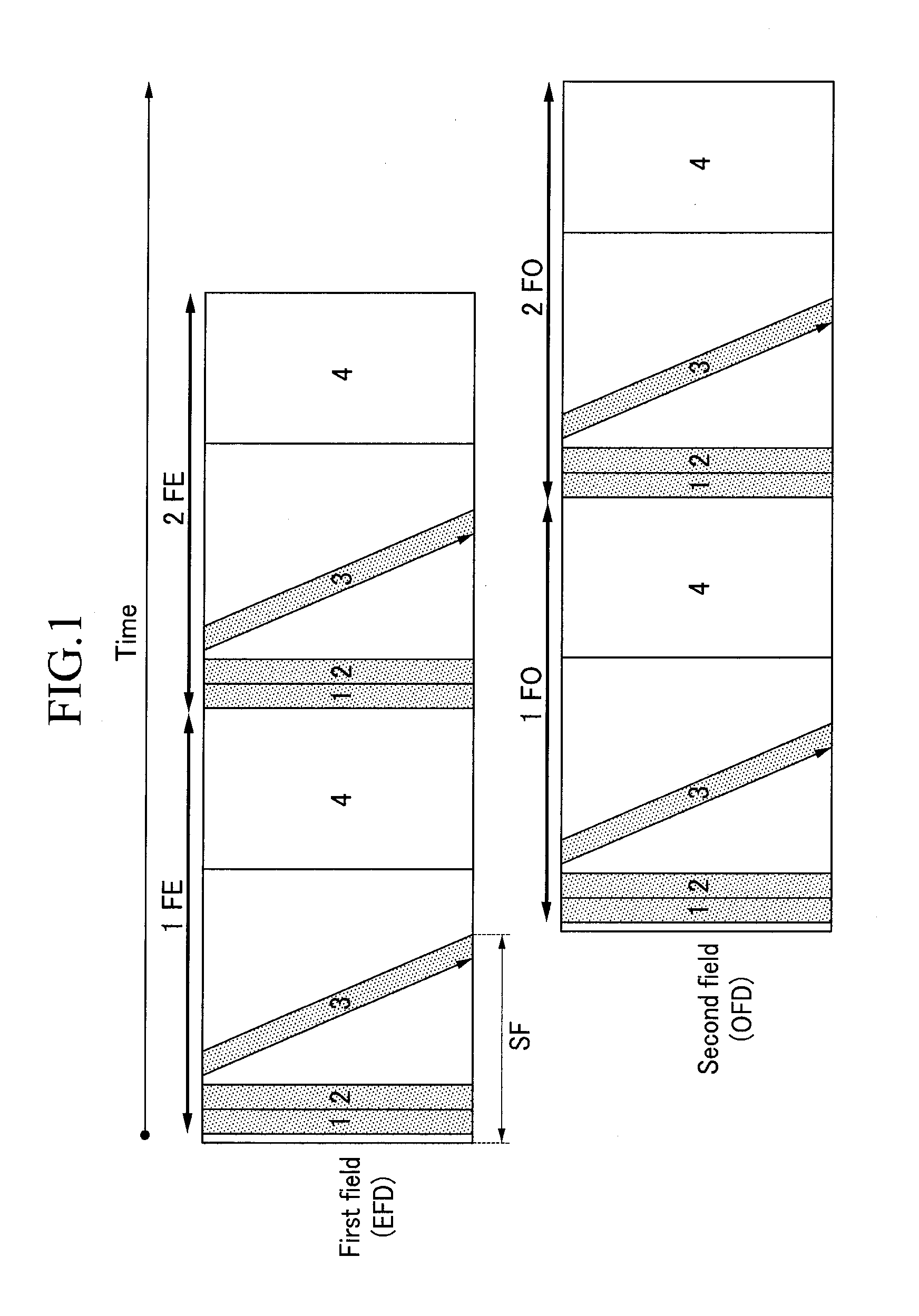

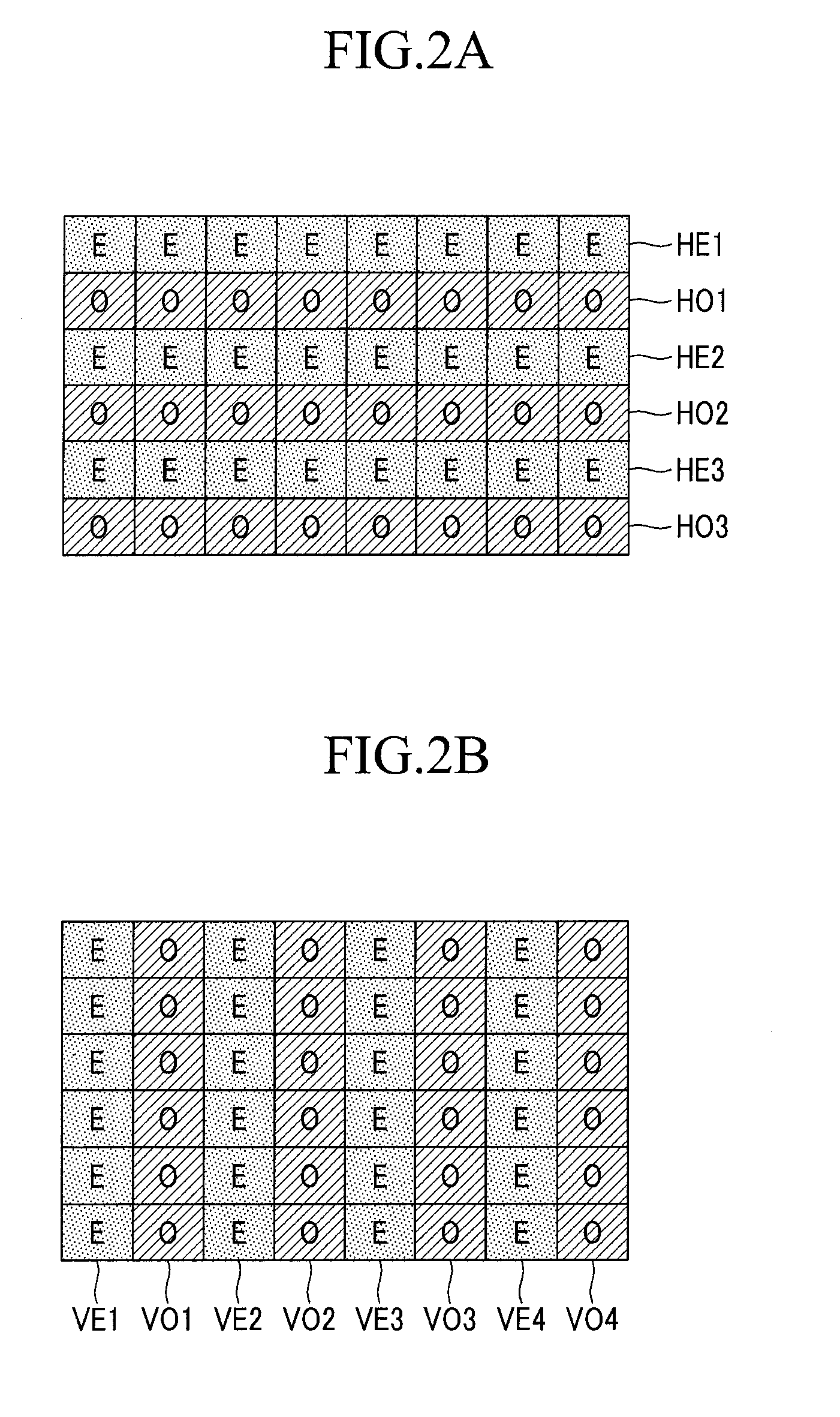

Display device and driving method thereof

ActiveUS20140062978A1Increase heightReduce brightness differenceCathode-ray tube indicatorsInput/output processes for data processingDisplay deviceData signal

A display device includes first pixels emitting light in a first field and second pixels emitting light in a second field. The first field includes a first compensation period during which threshold voltages of driving transistors of the first pixels are concurrently compensated, a first scan period during which scan signals corresponding to the first pixels are sequentially transmitted and corresponding data signals are programmed, and first light emission periods during which the first pixels concurrently emit light according to the data signals. The second field includes a second compensation period during which threshold voltages of driving transistors of the second pixels are concurrently compensated, a second scan period during which scan signals corresponding to the second pixels are sequentially transmitted and corresponding data signals are programmed, and second light emission periods during which the second pixels concurrently emit light according to the data signals.

Owner:SAMSUNG DISPLAY CO LTD

Pharmaceutical composition for treating coagulation disorder hemorrhage and method using the same

ActiveUS20130143836A1ImproveRapid recoveryBiocideCarbohydrate active ingredientsCoagulation DisorderL-Ornithine

Pharmaceutical composition for treating hemorrhage caused by blood clotting disorder and use thereof. The pharmaceutical composition comprises (per unit): L-ornithine 0.5-8 g, aspartic acid 1-5 g, arginine 3-10 g and vitamin B6 3-10 g. The pharmaceutical composition can treat hemorrhage caused by blood clotting disorder effectively and is very appropriate for treating patient at stake.

Owner:NANJING JIANRONG BIO TECH CO LTD

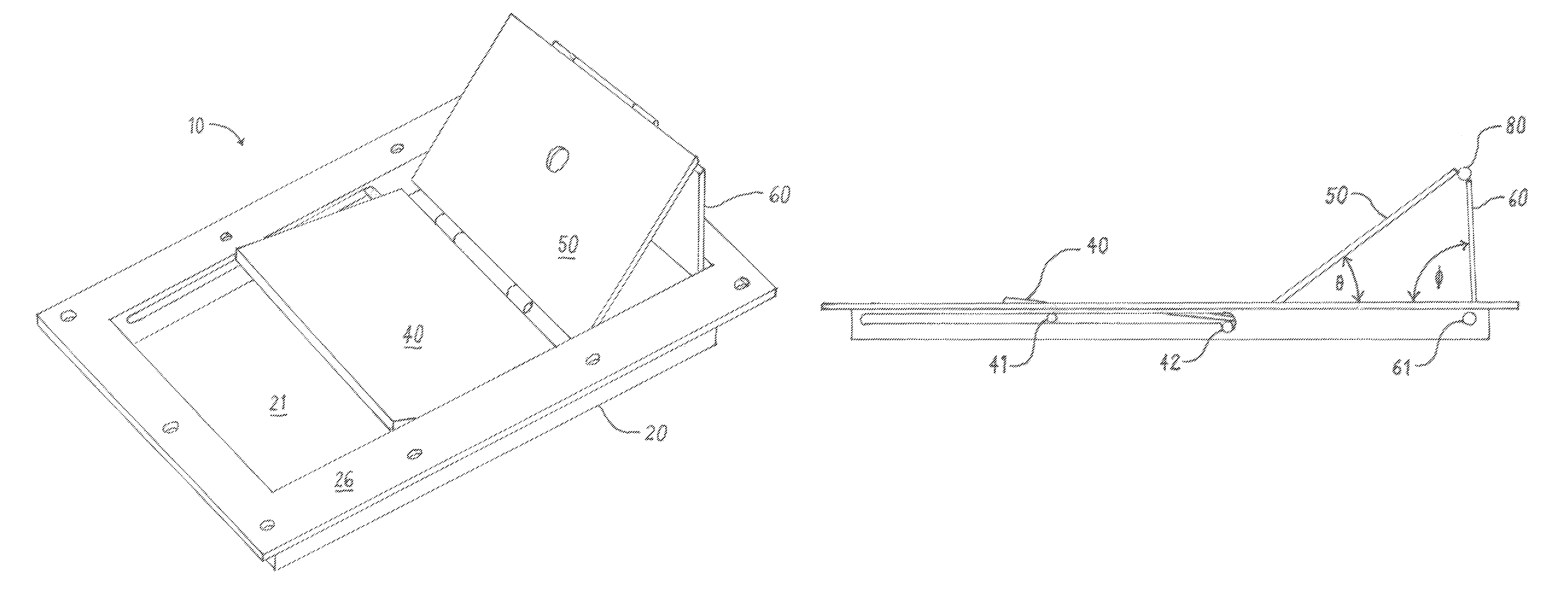

Wheel chock

A wheel chock comprises a tray and a folding cover. The cover contains three sections that are connected by hinges. When the cover is in a retracted position, it forms a flush solid surface. When the cover is in a raised functional position, its front section forms a sloped wheel platform and its middle and rear sections form a wedge.

Owner:RAGLAND LONNIE P

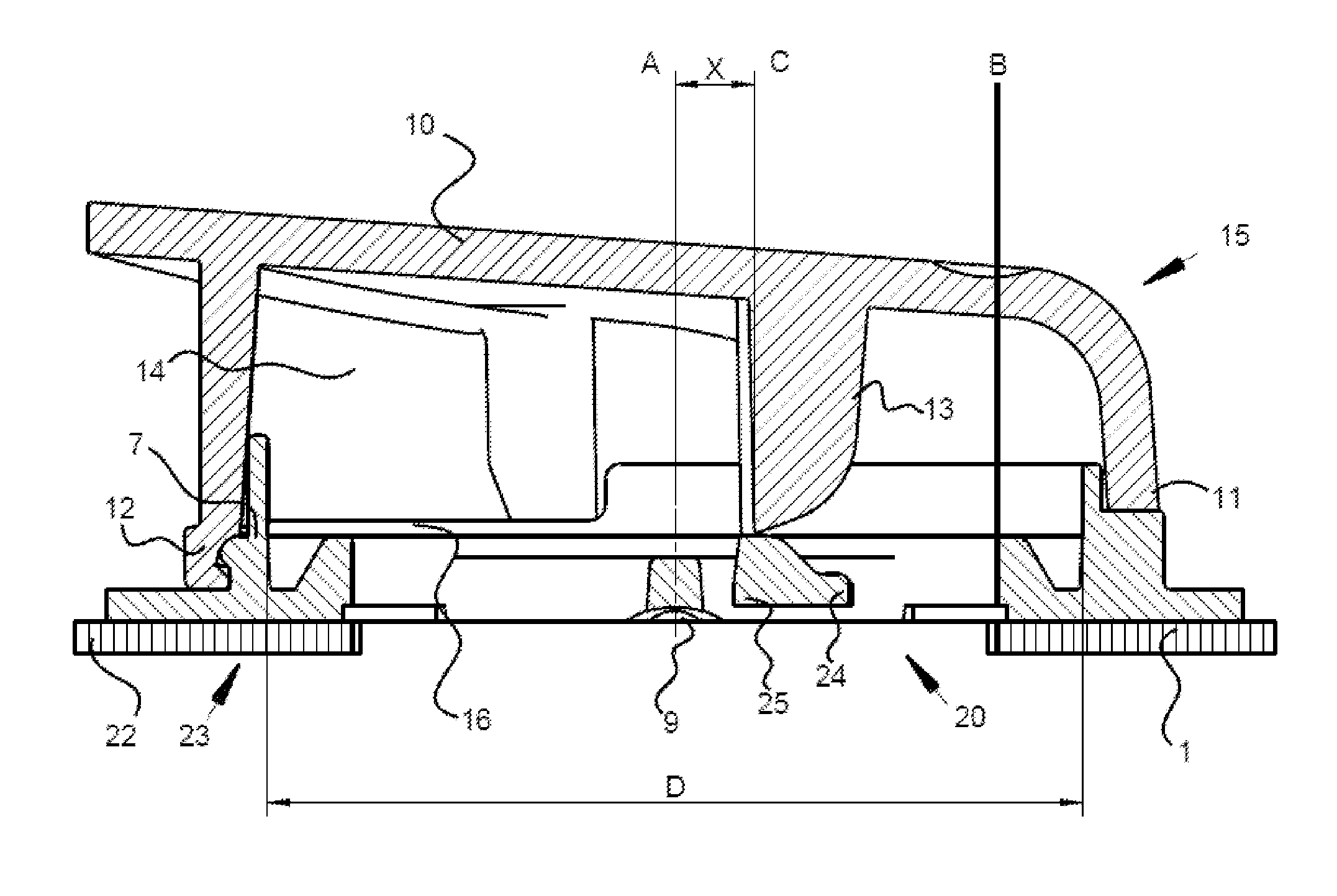

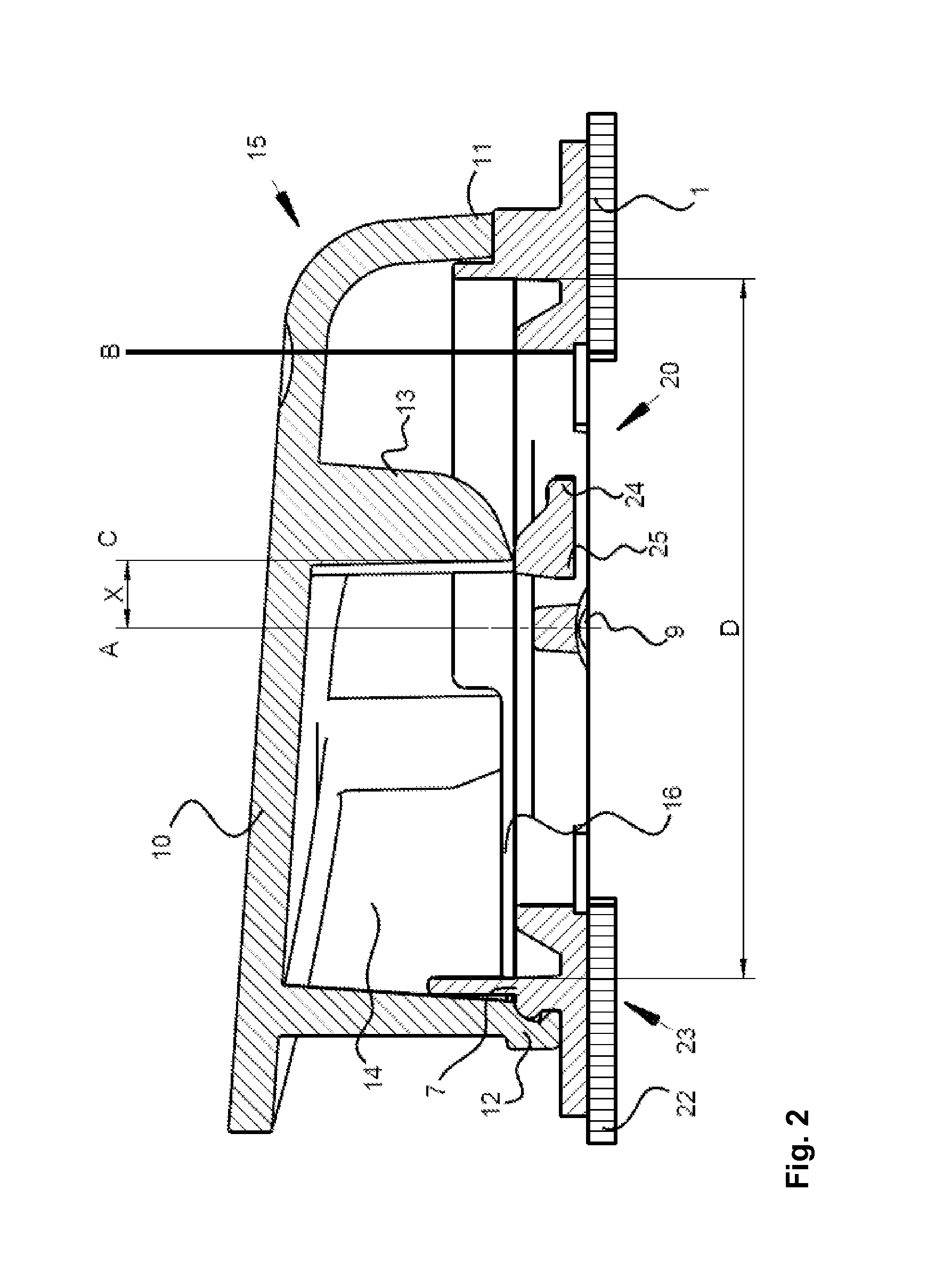

Directional valve and respirator product with a directional valve

ActiveUS20140076325A1ImproveHigh levelBreathing filtersBreathing masksMembrane configurationEngineering

A directional valve for a respirator product includes a valve housing (15) and a valve seat (1) for receiving a flexible valve membrane (16). The valve seat has a circular and essentially flat sealing surface (2) surrounding an opening (3), which is sealingly covered by the valve membrane during an inspiration phase. A fixing lug (13), on the valve housing (15), fixes the valve membrane in the valve seat and is arranged offset in relation to the center of the valve membrane, such that an entire circumferential surface of the valve membrane is lifted off from the sealing surface during an expiration phase. The fixing lug is directed essentially at right angles to a flow plane formed by the opening. A counter-support (25), within the opening, is arranged opposite the fixing lug such that the valve membrane is mounted with fixed clamping action, between the fixing lug and the counter-support.

Owner:DRAGER SAFETY

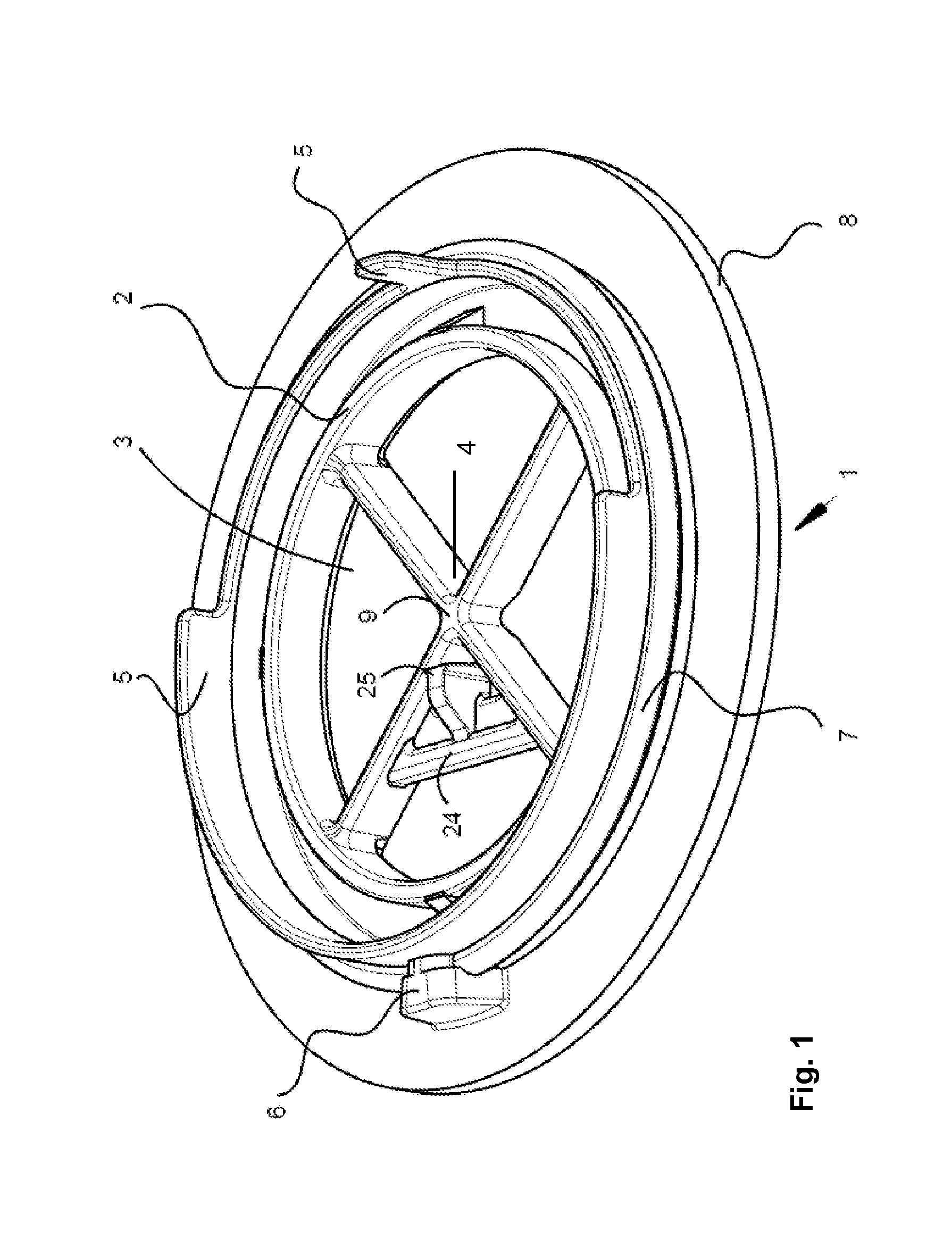

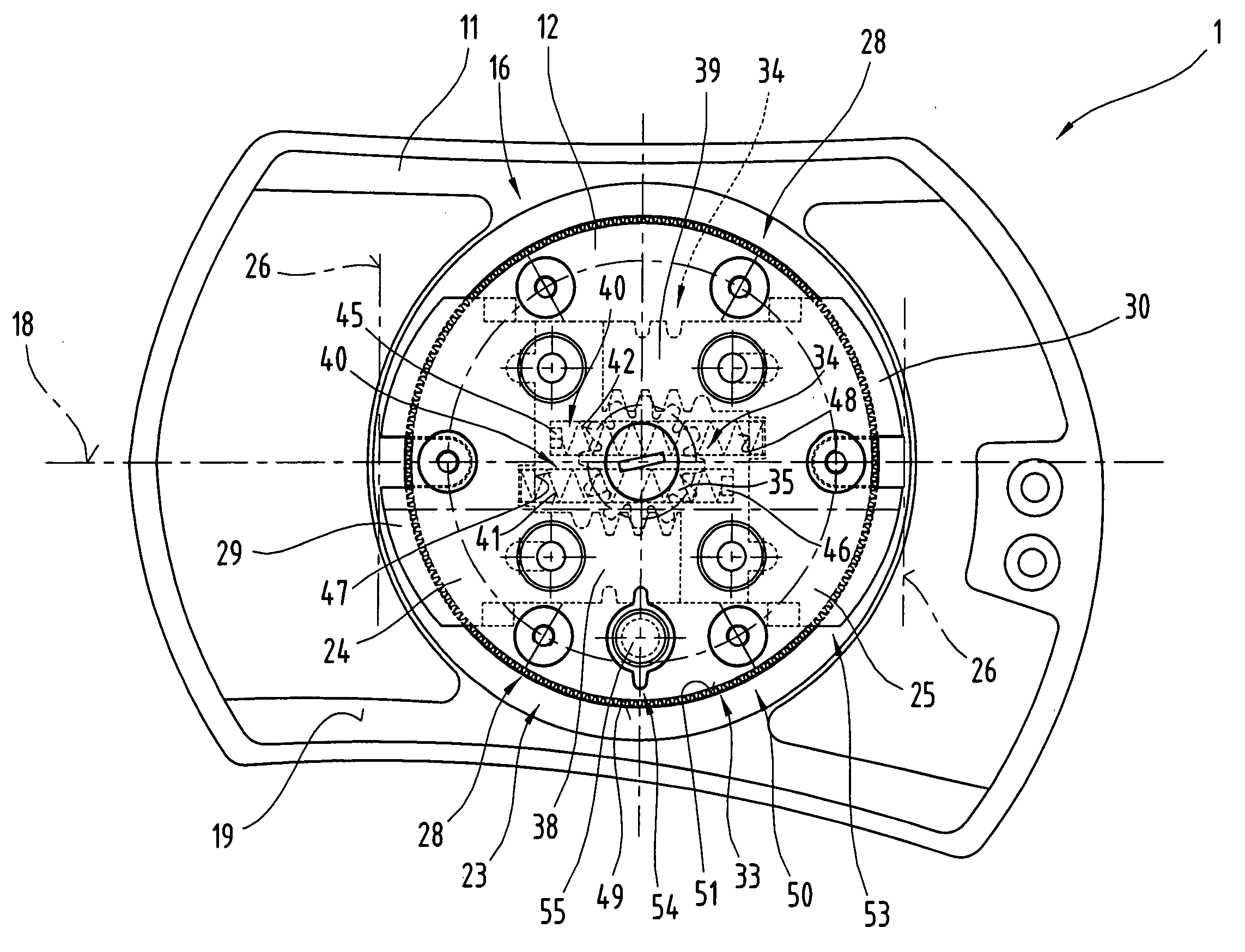

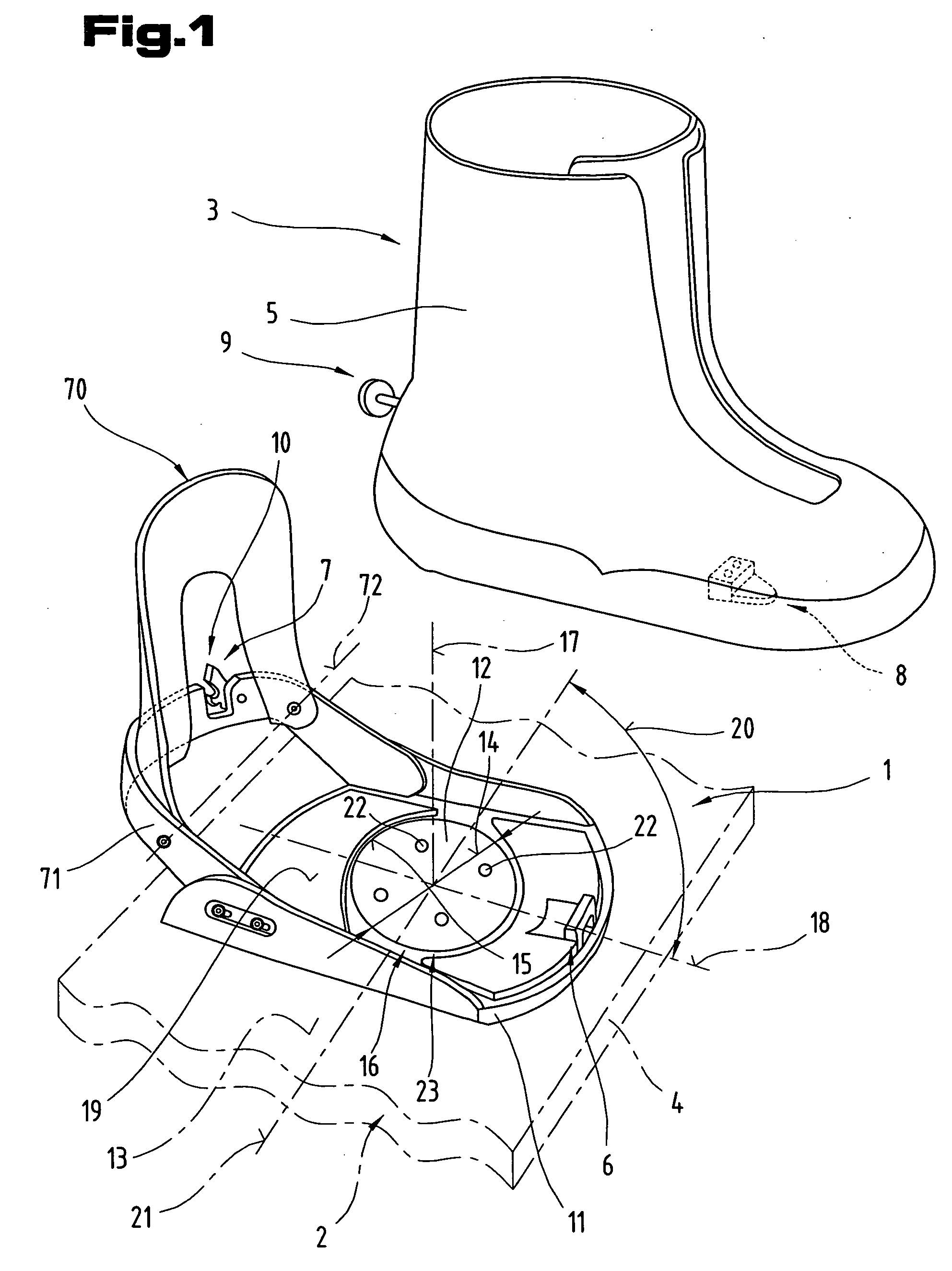

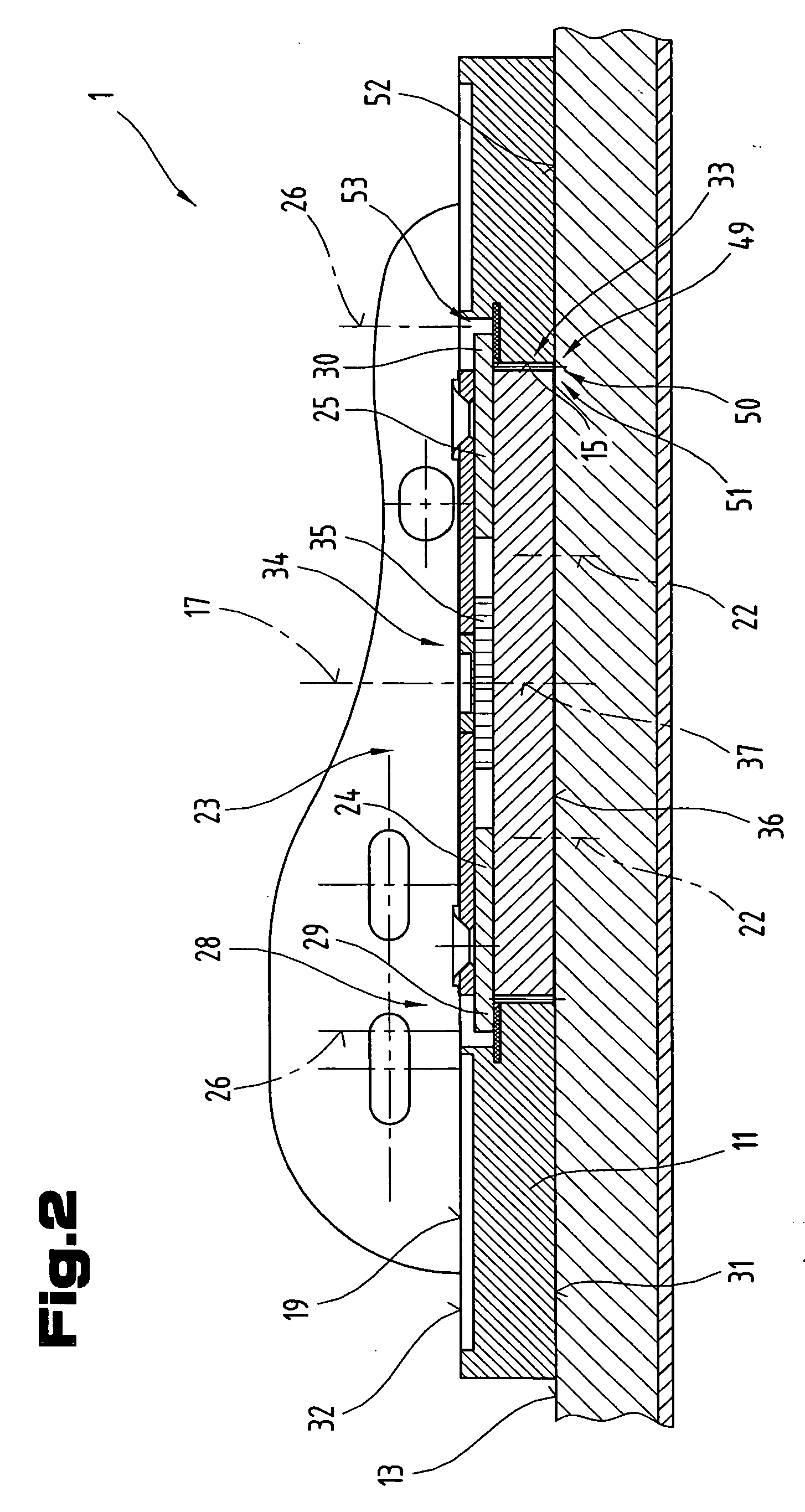

Binding unit for sports devices, in particular for a snowboard

InactiveUS20050093257A1ImproveImprove the binding unitSki bindingsCarriage/perambulator accessoriesEngineeringMechanical engineering

The invention relates to a binding unit (1) for sports devices, in particular for a snowboard. For the purpose of fixing it to the sports device, this binding unit (1) is provided with a retaining disc (12), which is substantially circular as seen in plan view, for a base plate (11) of relatively large surface area. Mounted on this base plate (11), either directly or indirectly, are coupling parts to provide a connection to a sports shoe, in particular a snowboard shoe. Teeth (49, 51) are also provided between the base plate (11) and the retaining disc (12) inserted therein through a central orifice (15) or corresponding recess. The teeth (49, 51) are provided as a means of securely fixing selectively adjustable and fixable angular positions between the retaining disc (12) and the base plate (11). At least one slide element (24, 25) is provided on the retaining disc (12) and is displaceable from an extracted position (26), in which it spans or overlaps a transition region (28) between the retaining disc (12) and the base plate (11), to an inserted position, in which the slide element (24, 25) does not span or overlap the transition region (28) between the retaining disc (12) and the base plate (11) and vice versa.

Owner:ATOMIC AUSTRIA

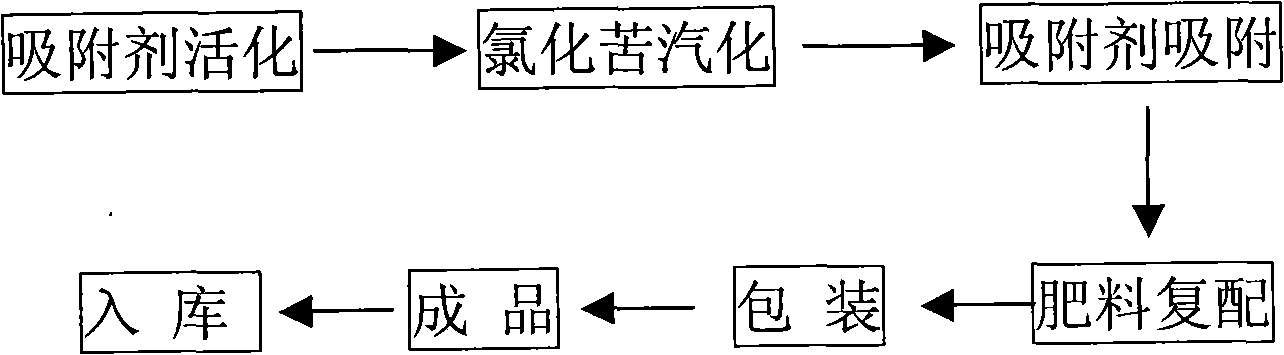

Fertilizer for soil sterilization for preventing and controlling continuous cropping disease

InactiveCN101318865ABreak through the bottleneck that cannot be promoted on a large scaleIncrease productionFertilizer mixturesContinuous croppingDisease

The present invention relates to a fertilizer capable of disinfecting soil for preventing a replant disease, and a manufacturing method thereof. The raw materials of the invention are active carbon and zeolite, which absorb chloropicrin, and manure. The materials are made by a scientific method according to a certain proportion to produce a novel fertilizer which takes the prior practice of basal dressing during crop planting and disinfects the soil while fertilizing, thereby not only performing the disinsection and sterilization of the chloropicrin, but also simplifying the application of the chloropicrin and eliminating the potential risk of chloropicrinism. The method enables farmers to use chloropicrin to prevent the replant disease of crop conveniently and safely while achieving the aim of increasing yield and harvest. After the soil disinfection, no harmful residue is left in the soil and the crop, and thus the method can be used for producing harmless agricultural products.

Owner:张迎秋

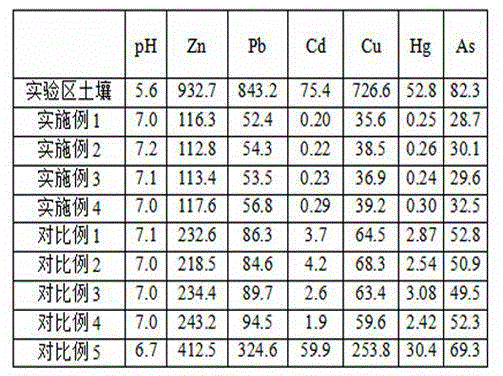

Restoration method for industrial waste land soil heavy metal contamination

ActiveCN105170642AReduce the difficulty of plantingReduce degradationContaminated soil reclamationRestoration methodSoil heavy metals

The invention provides a restoration method for industrial waste land soil heavy metal contamination. Charcoal base fertilizer and a microorganism complex microbial inoculant are applied to heavy metal contaminated soil, and the charcoal base fertilizer, the microorganism complex microbial inoculant and the soil are evenly mixed and then aged; after ageing is over, a willow is planted, and the willow is overall removed after a certain period; after the willow is overall removed, charcoal base fertilizer and a microorganism complex microbial inoculant are applied to the soil where the willow is planted again, and the charcoal base fertilizer, the microorganism complex microbial inoculant and the soil are evenly mixed and aged; after ageing restoration is over, ricinus communis is planted, and the ricinus communis is overall removed after ricinus communis fruits are harvested; and the steps are executed cyclically and repeatedly until the content of heavy metal in the soil reaches the safety standard. The restoration method is good in soil governing effect, fast in effect taking, short in time, capable of beautifying the environment while the heavy metal contaminated soil is governed and high in practicability.

Owner:福建沃土环保集团有限公司

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com